Patents

Literature

35 results about "Lump sum" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A lump sum is a single payment of money, as opposed to a series of payments made over time (such as an annuity). The United States Department of Housing and Urban Development distinguishes between "price analysis" and "cost analysis" by whether the decision maker compares lump sum amounts, or subjects contract prices to an itemized cost breakdown.

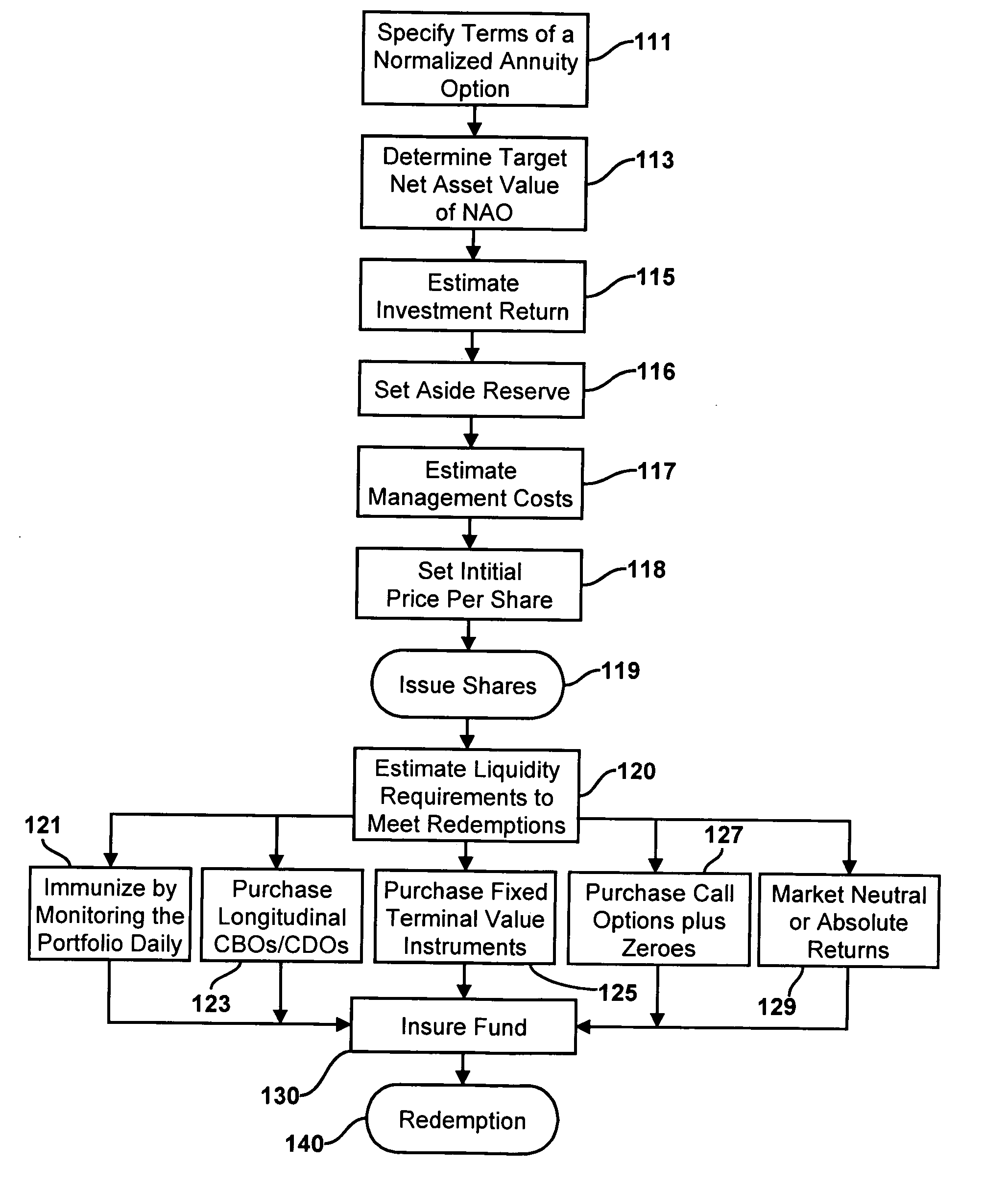

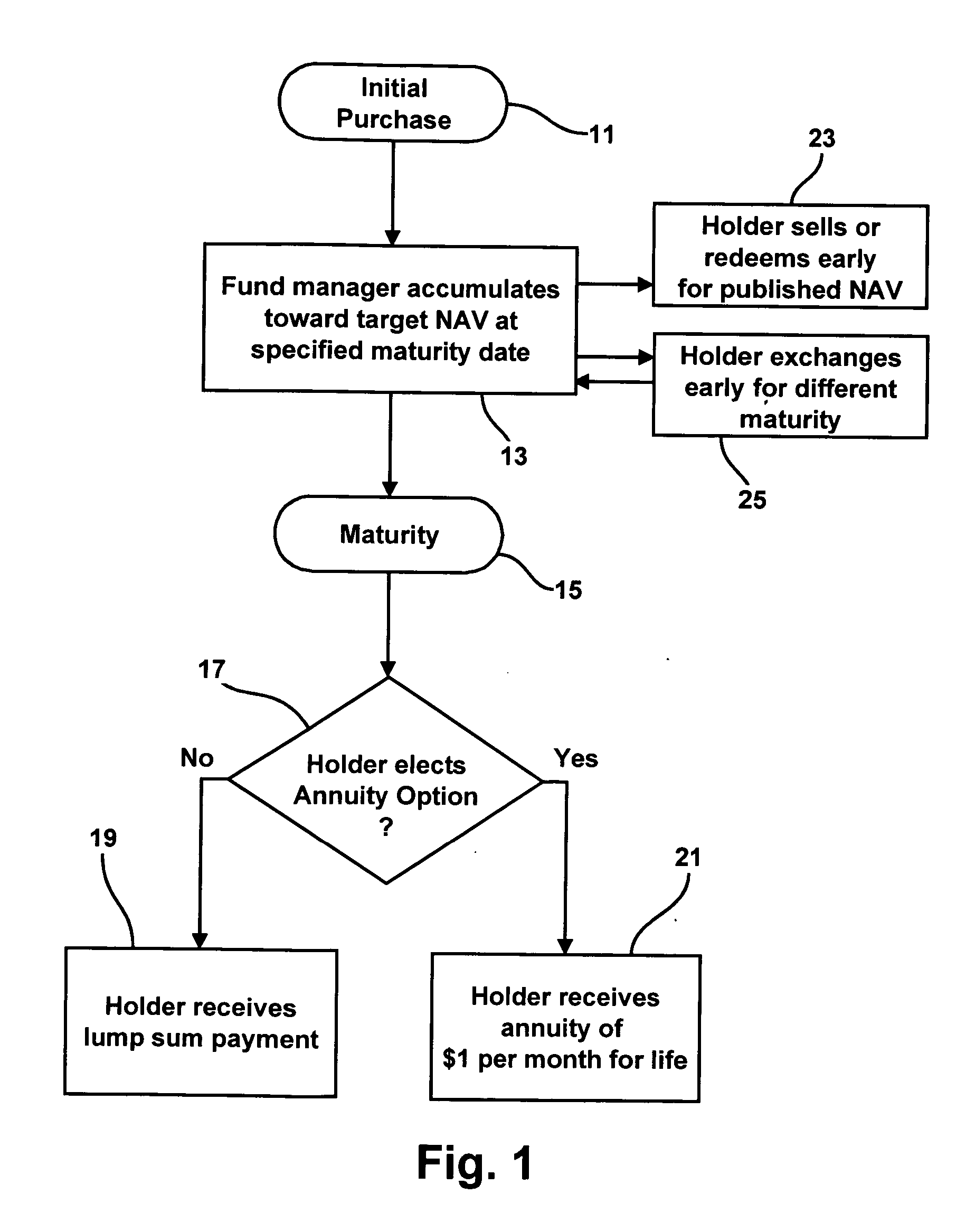

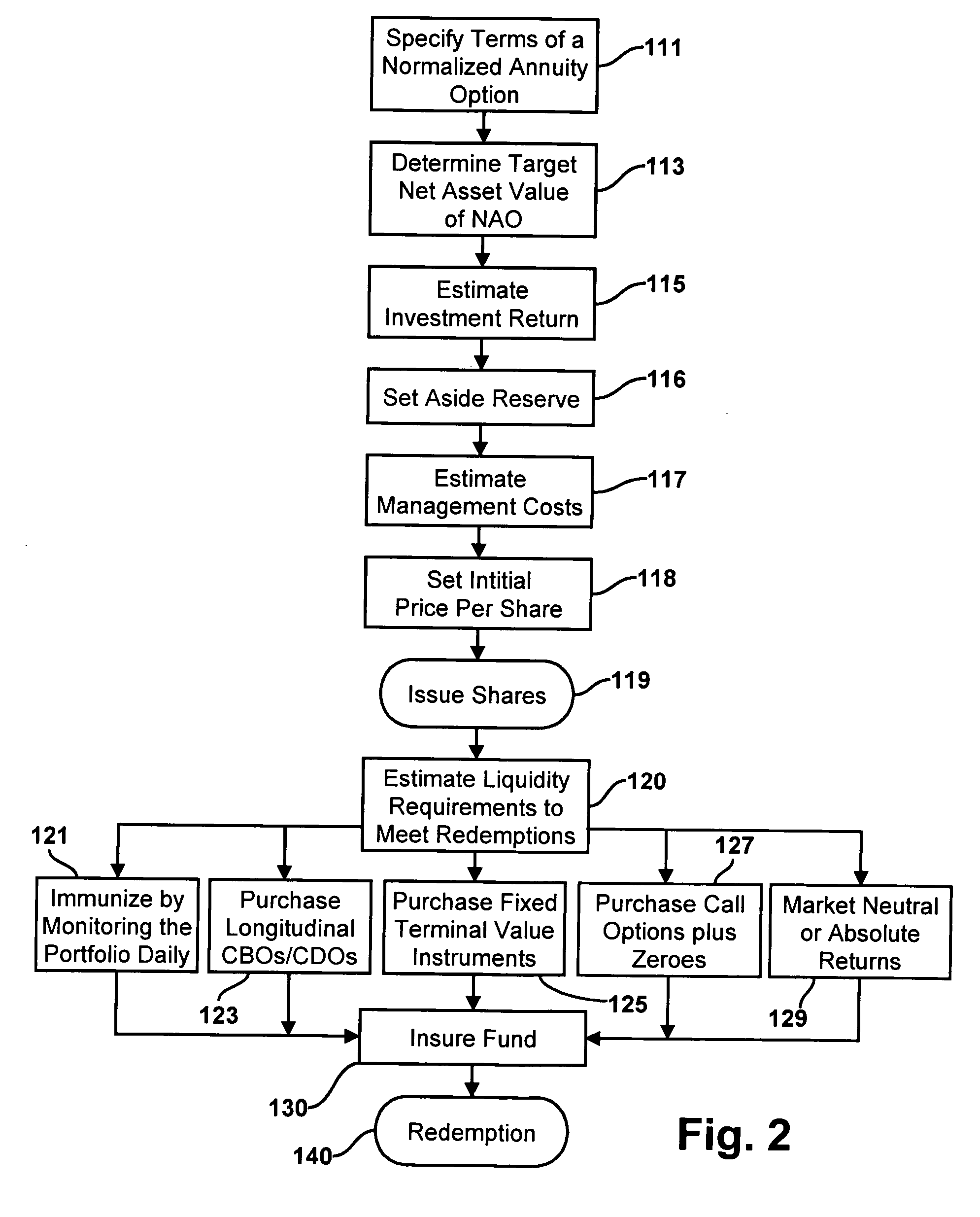

Methods for issuing, distributing, managing and redeeming investment instruments providing normalized annuity options

A method of issuing and managing investment instruments called “Pension Shares” which preferably take the form of securities that represents a claim against and is secured by an investment fund. A Pension Share entitles its holder to receive, at a specified maturity date, either a lump sum payment amount or, at the option of said holder, to receive a sequence of annuity payments. The Pension Share issuer creates and manages the investment fund such that its net asset value at the maturity date will be adequate to make the lump sum payment or provide the holder with the annuity. A preferred form of Pension Share provides an annuity option of one dollar per for the life of the holder, or his or her survivor, both of whom are at a predetermined age at the maturity date. A Pension Share may be redeemed on demand in advance of the maturity date so that it may be exchanged for a Pension Share having a different maturity date if the holder's plans change.

Owner:RETIREMENT ENG

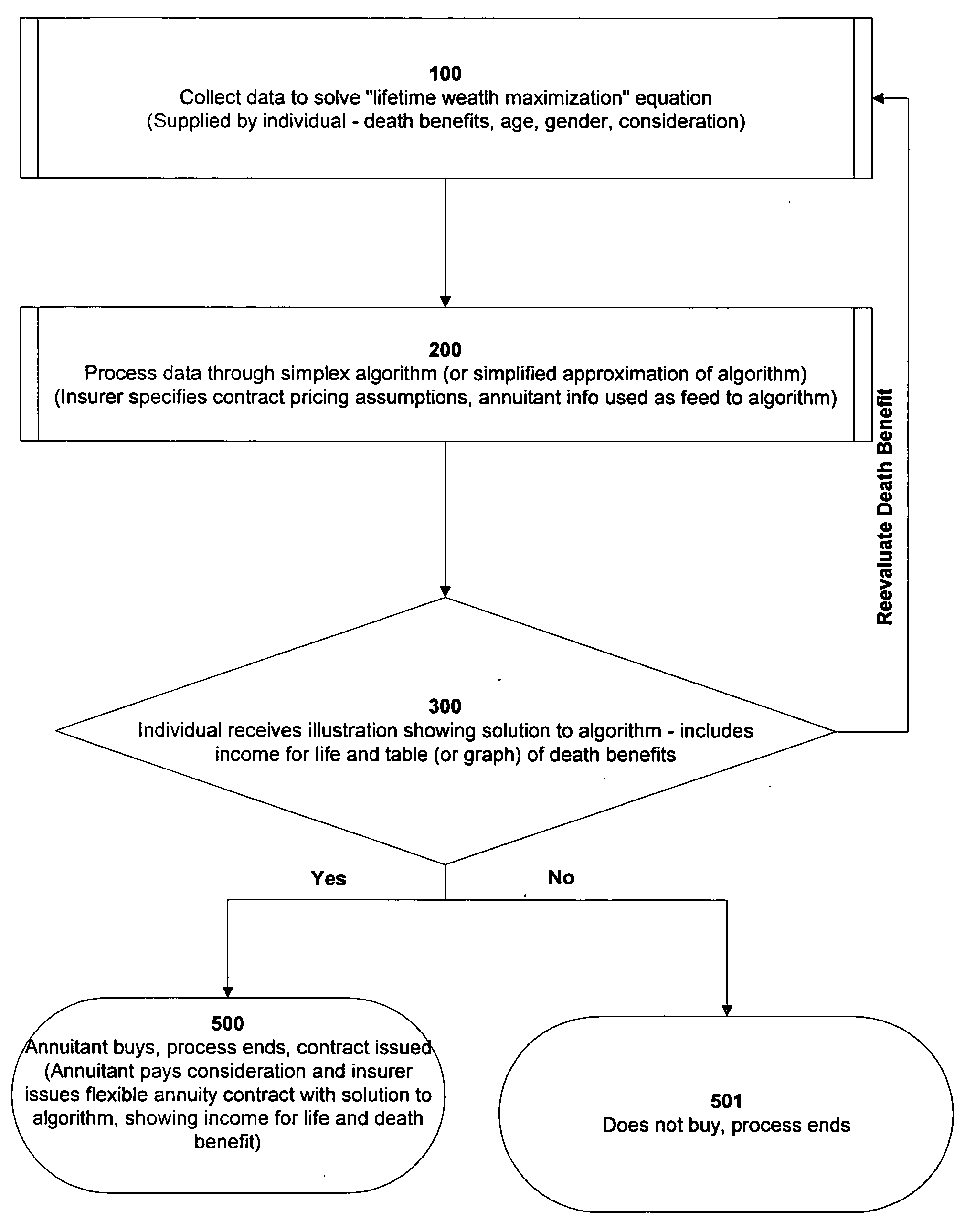

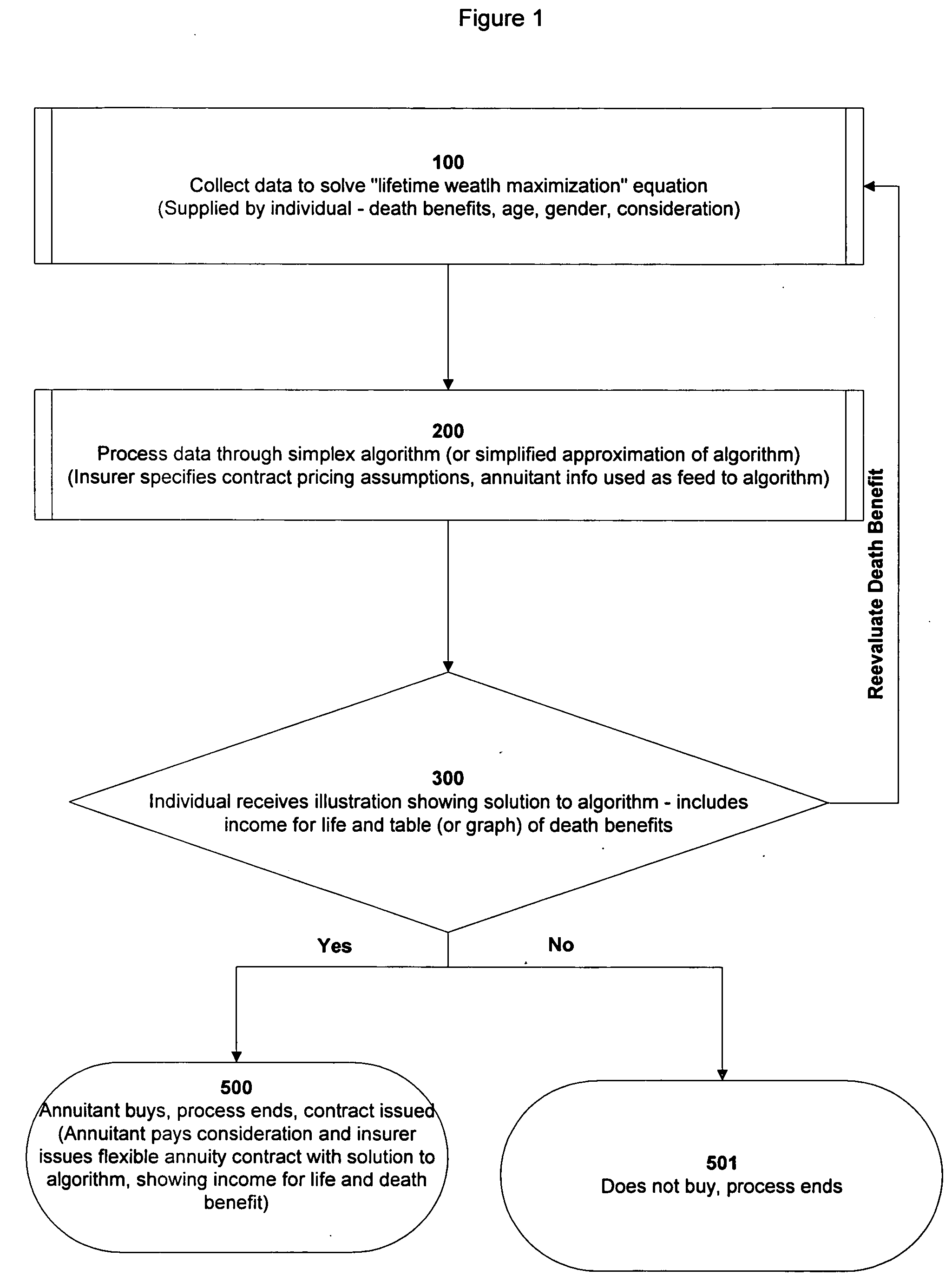

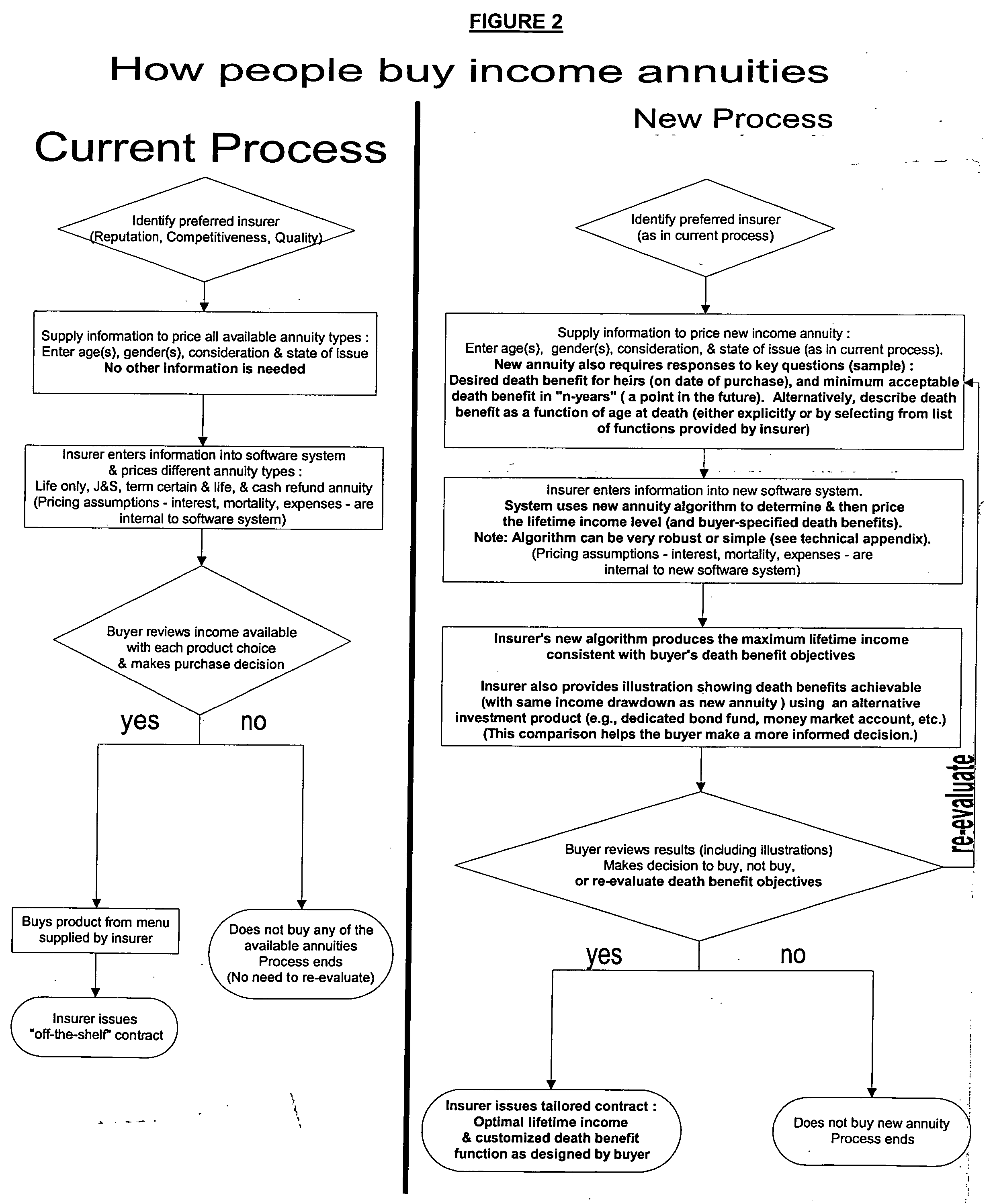

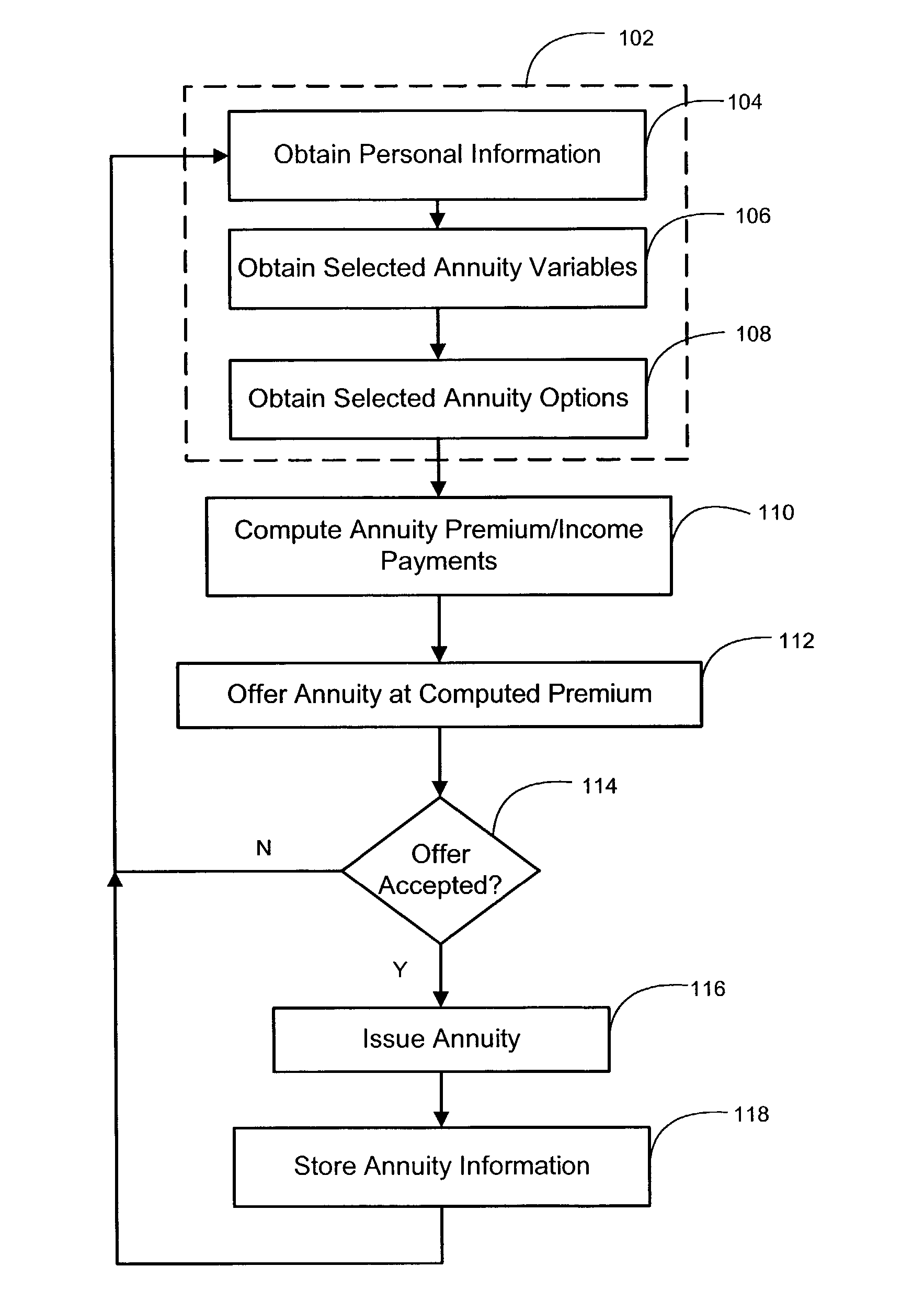

Method for determining an optimal and tailored lifetime income and death benefit package

An annuitant is able to select and optimize the allocation of a premium for insurance coverage between lifetime income benefits for the annuitant and death benefits to the annuitant's beneficiaries. A set of underwriting factors is established to provide the insurance coverage and value both the lifetime income to the annuitant and the death benefits payable to the beneficiaries. These factors include anticipated investment returns on the premium paid for the coverage, and which are used for both the income and death benefit components of the coverage. The annuitant uses these to derive a combination of lifetime income for the annuitant and death benefits available to the annuitant's beneficiaries. To do so, the annuitant inputs personal information including minimum dollar death benefit acceptable to the annuitant if the annuitant's death occurred immediately after the issue of the coverage, and the minimum death benefit to the designee if the annuitant's death occurs on or after some future date. This generates a solution showing the dollar death benefits payable in a lump sum to the beneficiaries at various possible dates of death into the future, as well as the corresponding lifetime income available for the annuitant.

Owner:FINANCIAL DESIGNS

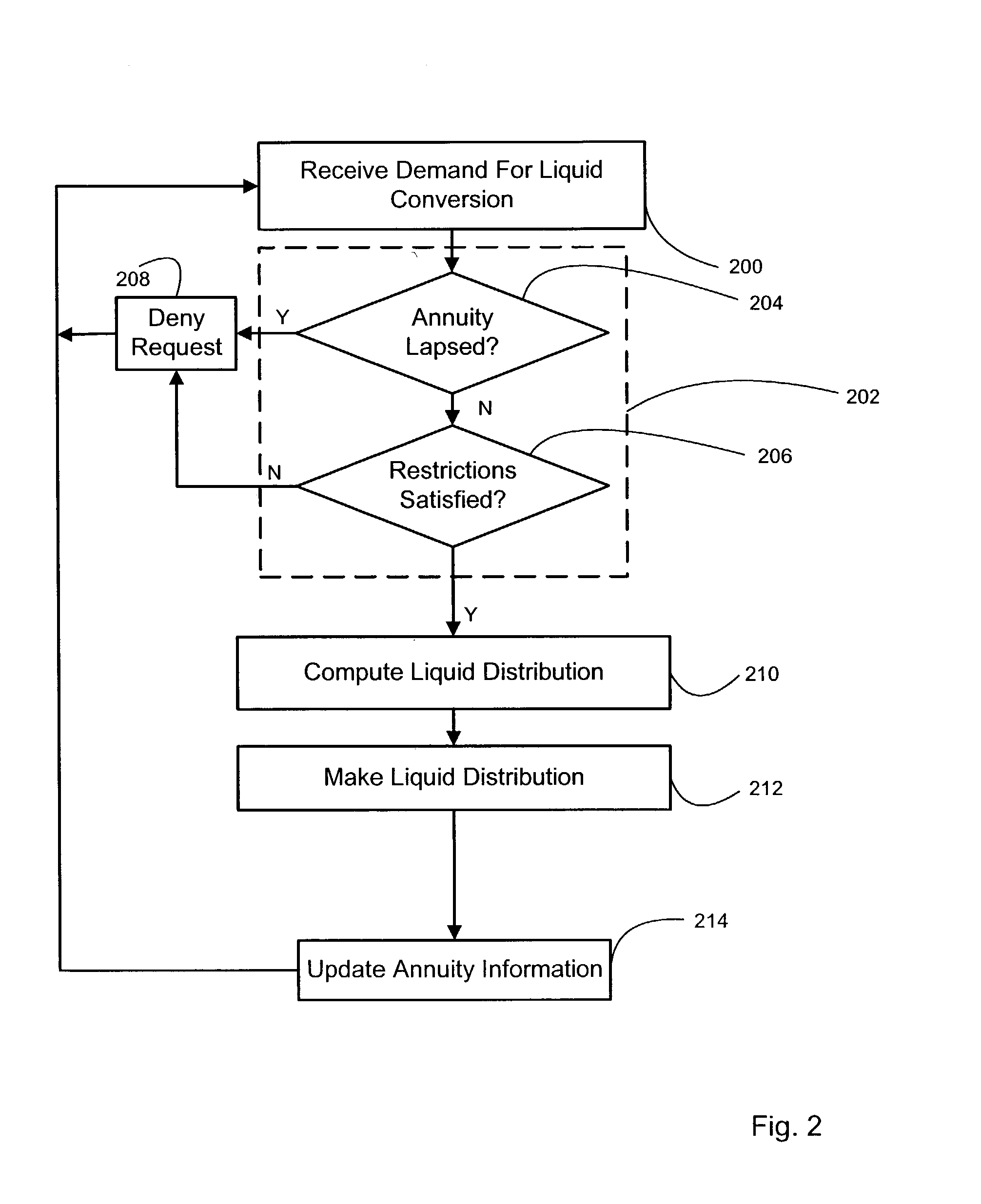

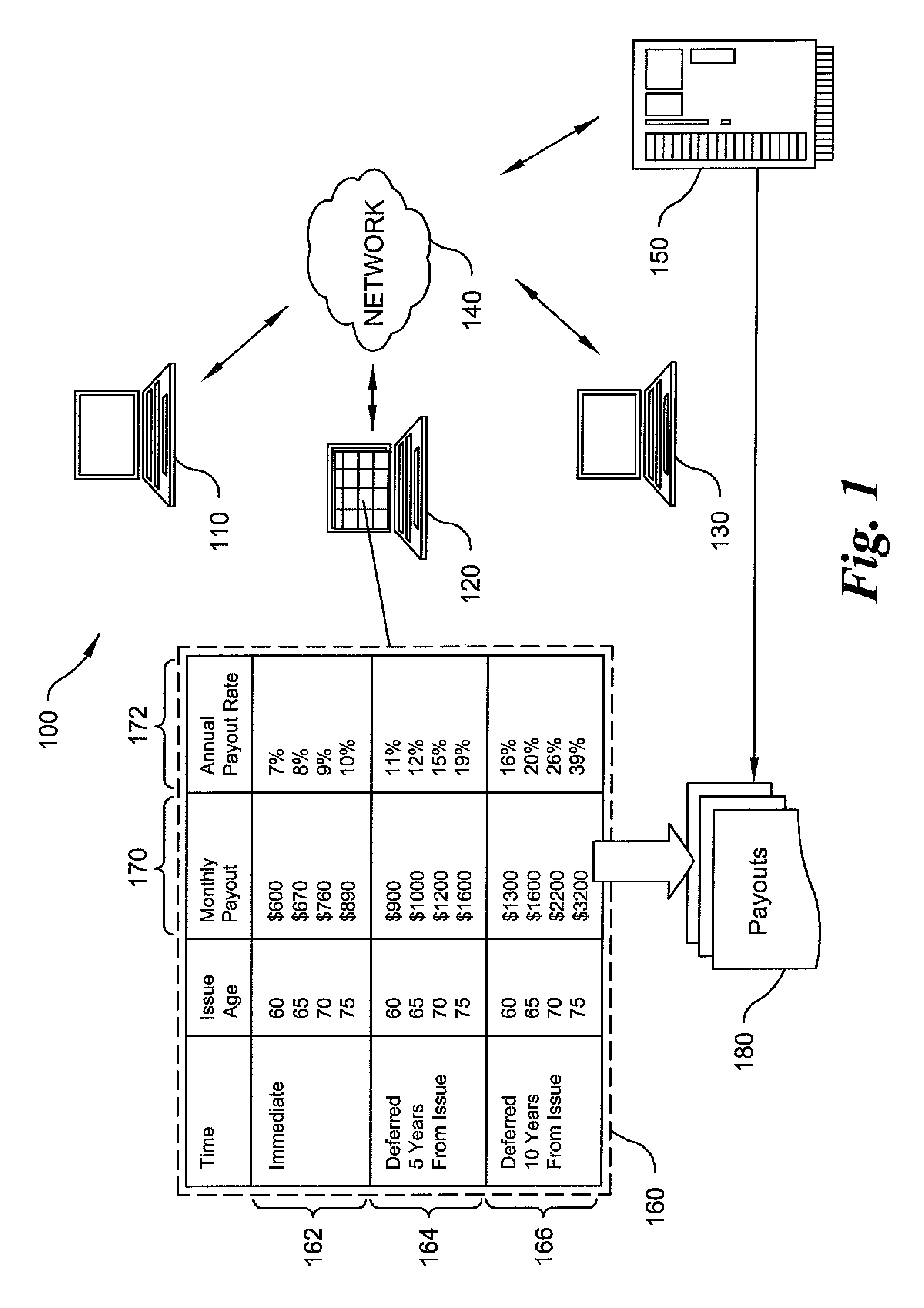

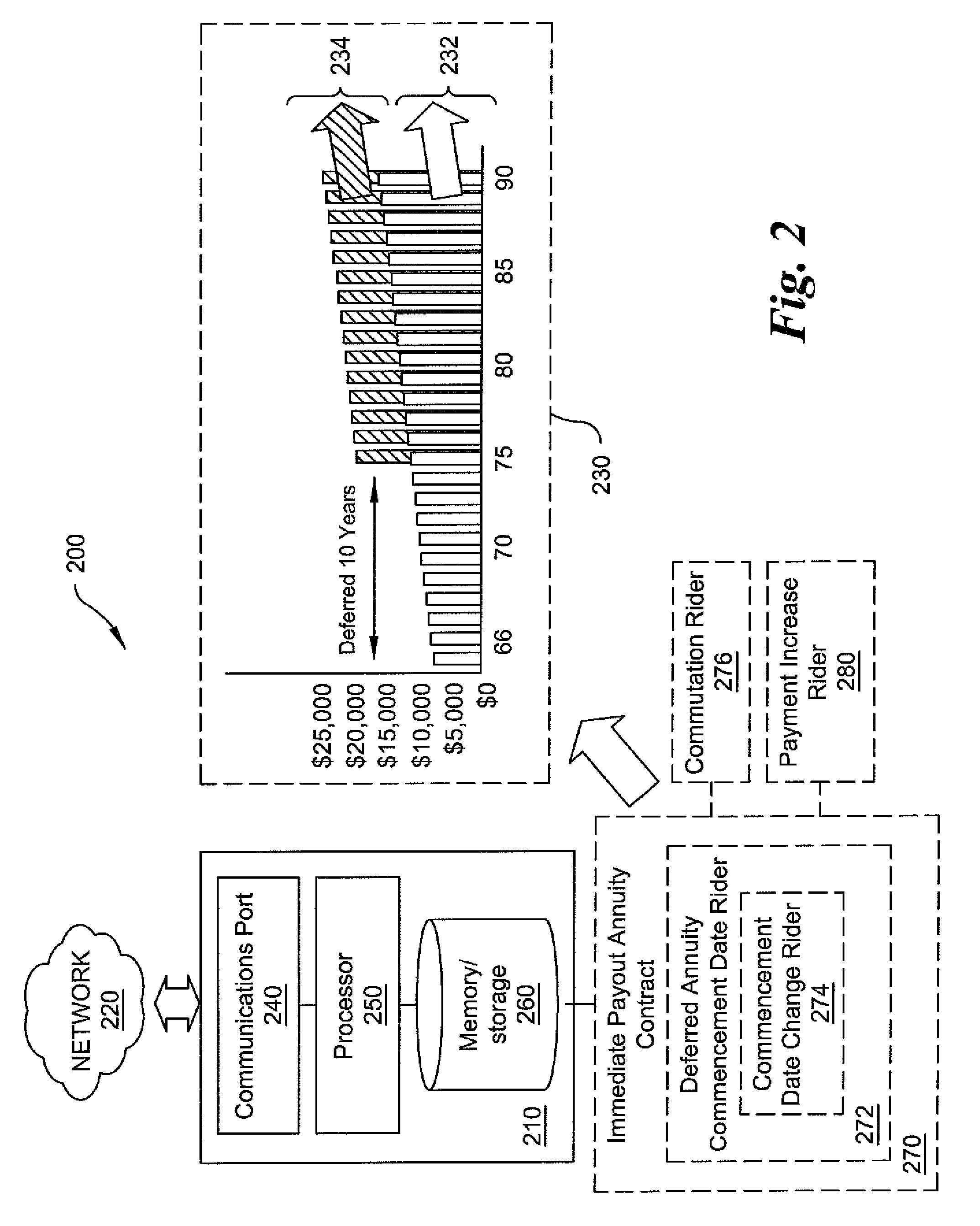

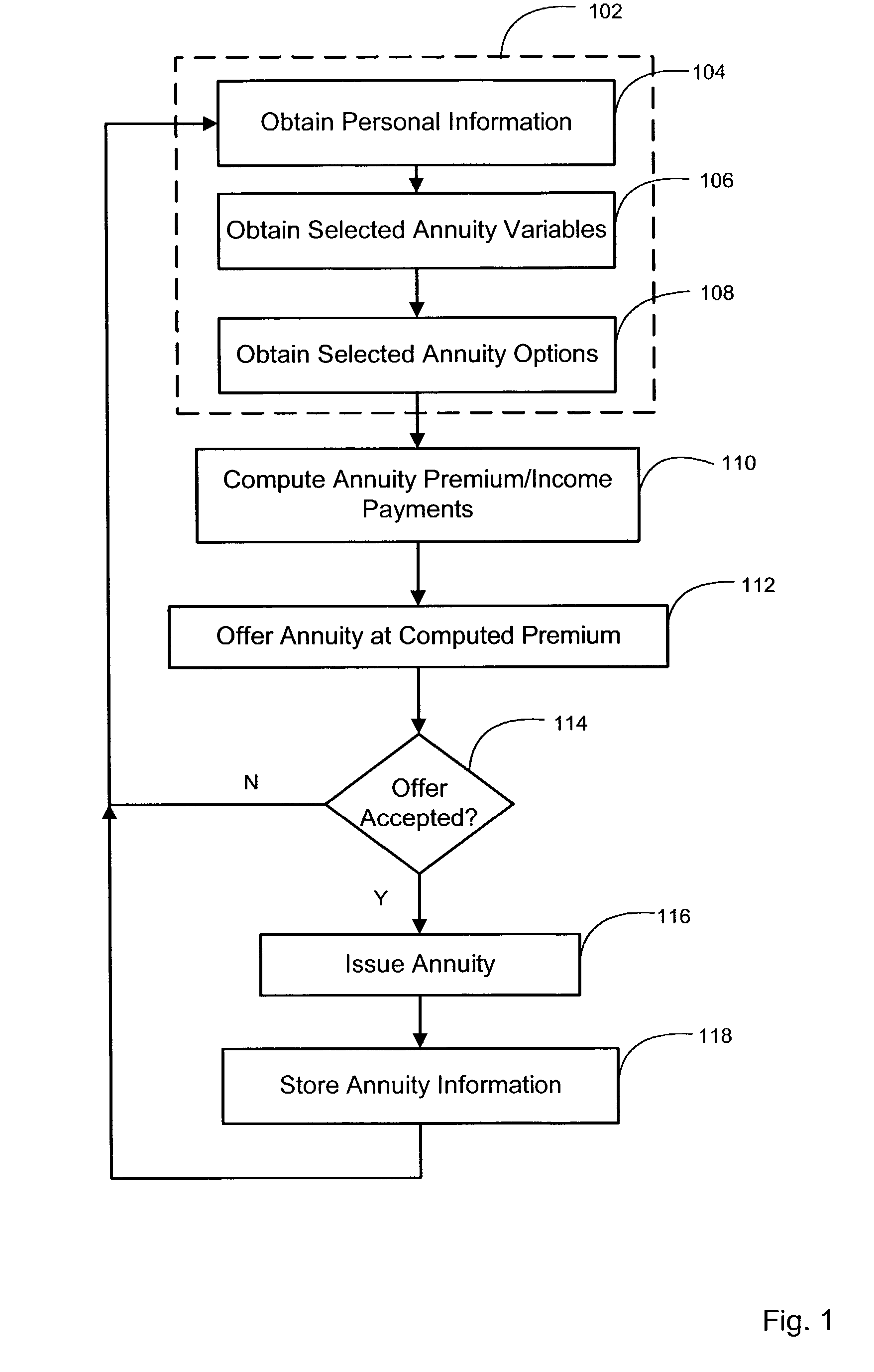

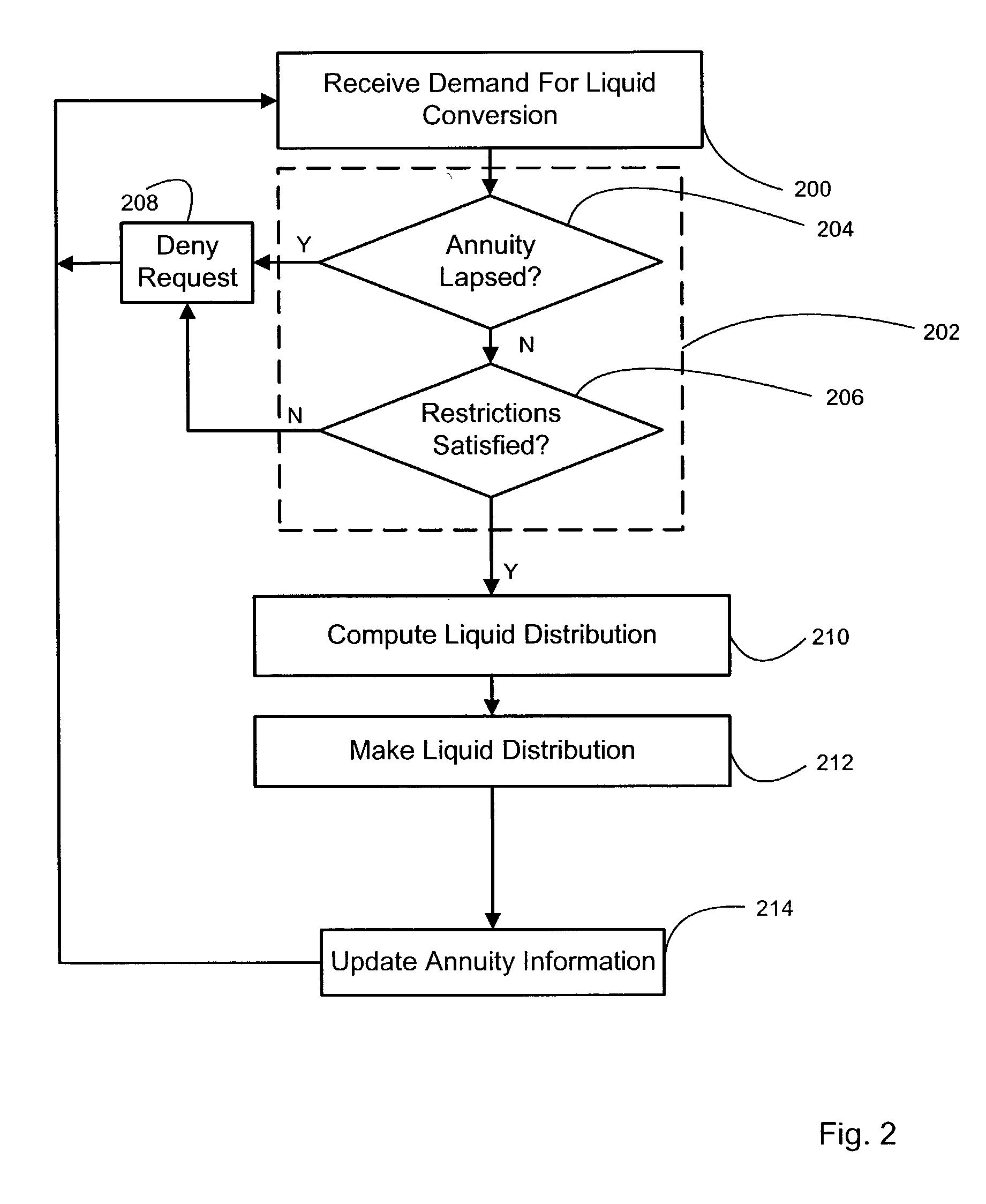

Methods and systems for providing liquidity options and permanent legacy benefits for annuities

This invention relates to methods and systems that provide annuities with at least one liquidity option that allows the holder of the liquidity option to exercise the option and convert therewith a portion of a value of the annuity into a liquid asset, such as cash or a cash value, based on the value of future income payments, which can include payments that are guaranteed to be paid for the duration of one or more lifetime. The conversion may be in a variety of forms, such as an advance of at least a portion of the future income payments, or in the form a lump sum distribution of at least a portion of a commuted value of the annuity computed based at least in part on the present value, at the time of the conversion, of future income payments for the remainder of the guarantee period. This invention further relates to methods and systems that provide annuities including a liquid legacy benefit option that provide a lump sum distribution of a portion of an annuity premium to a beneficiary at the end of the guarantee period that is substantially certain at the inception of the annuity.

Owner:NEW YORK LIFE INSURANCE COMPANY

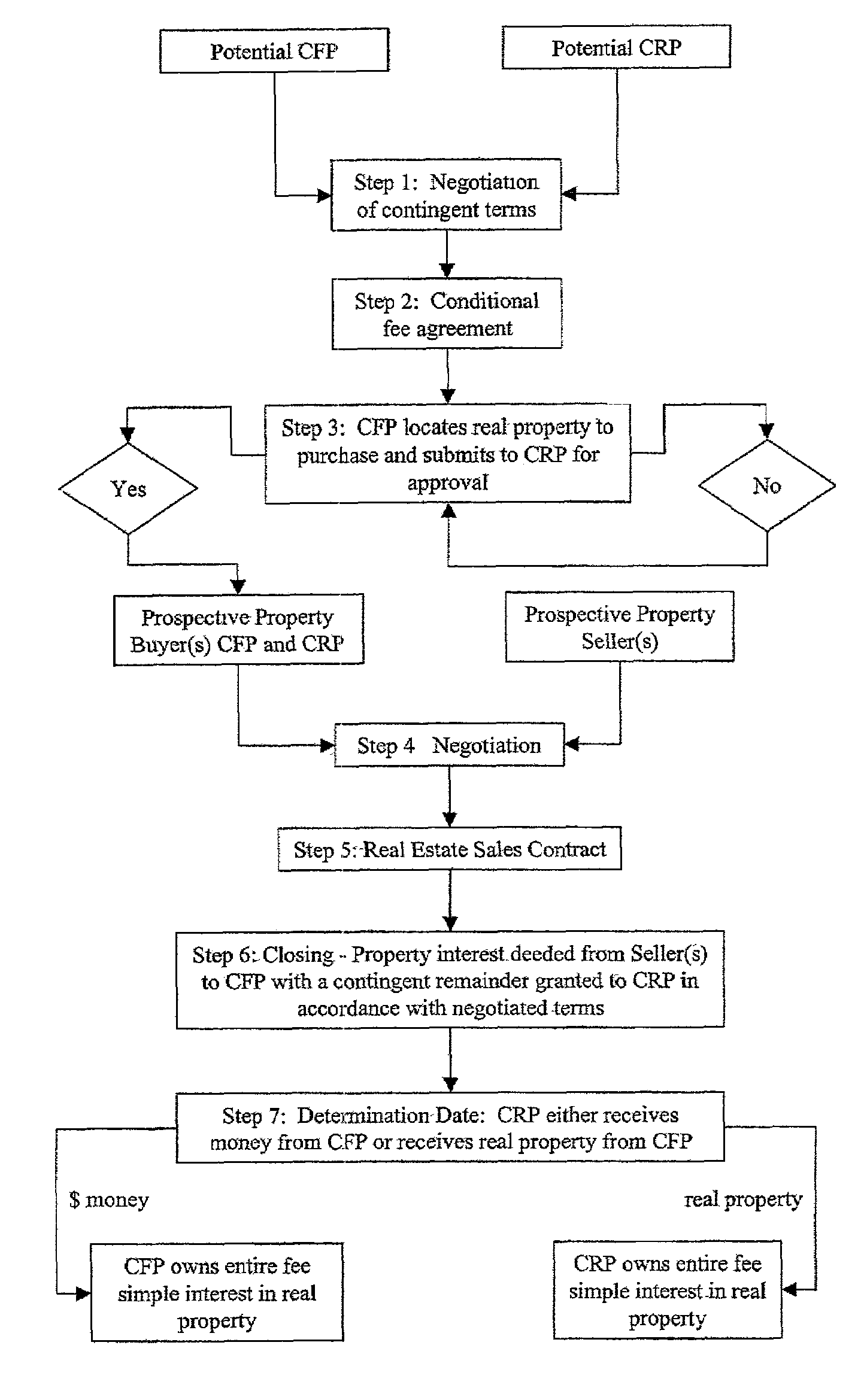

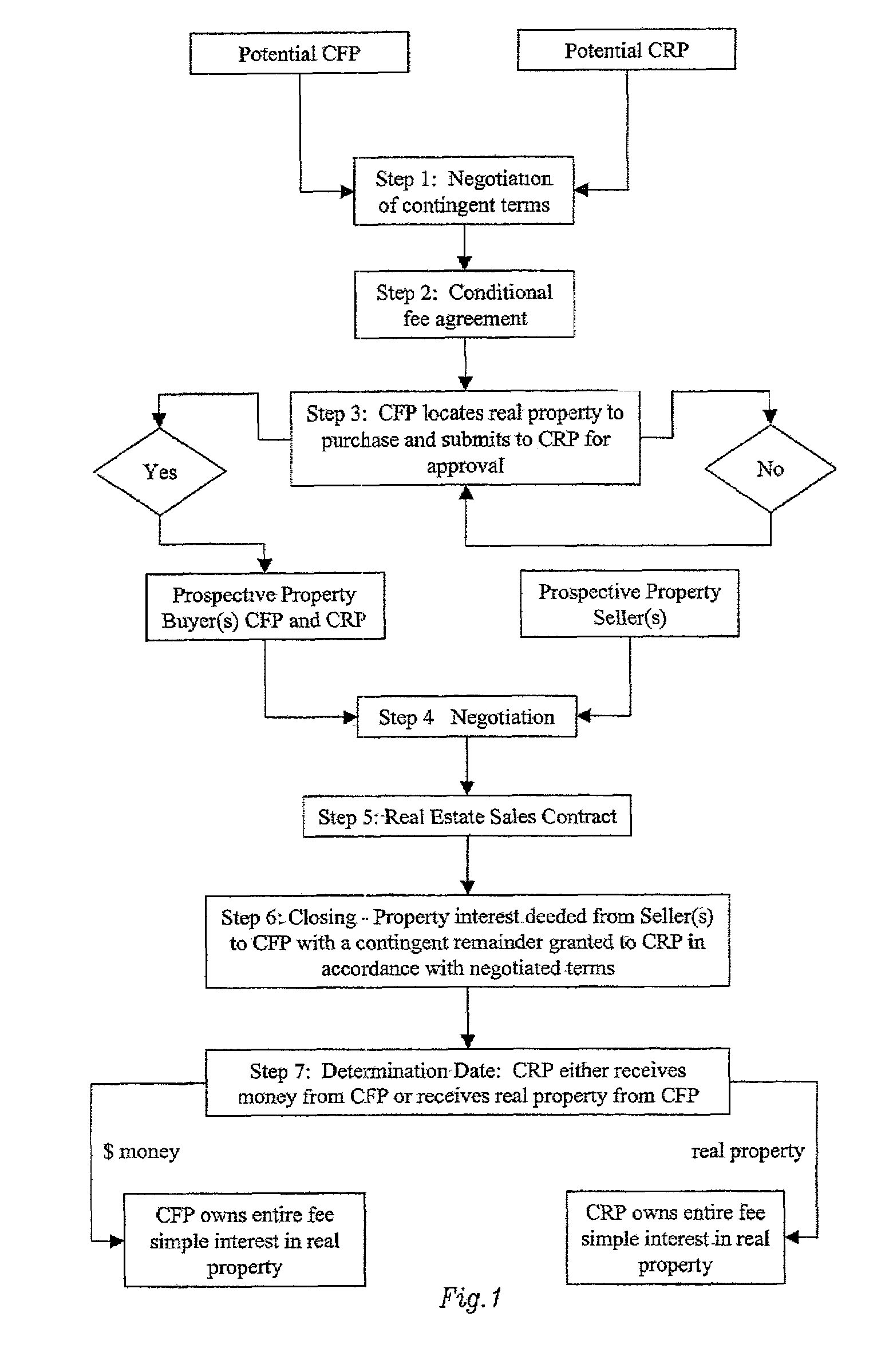

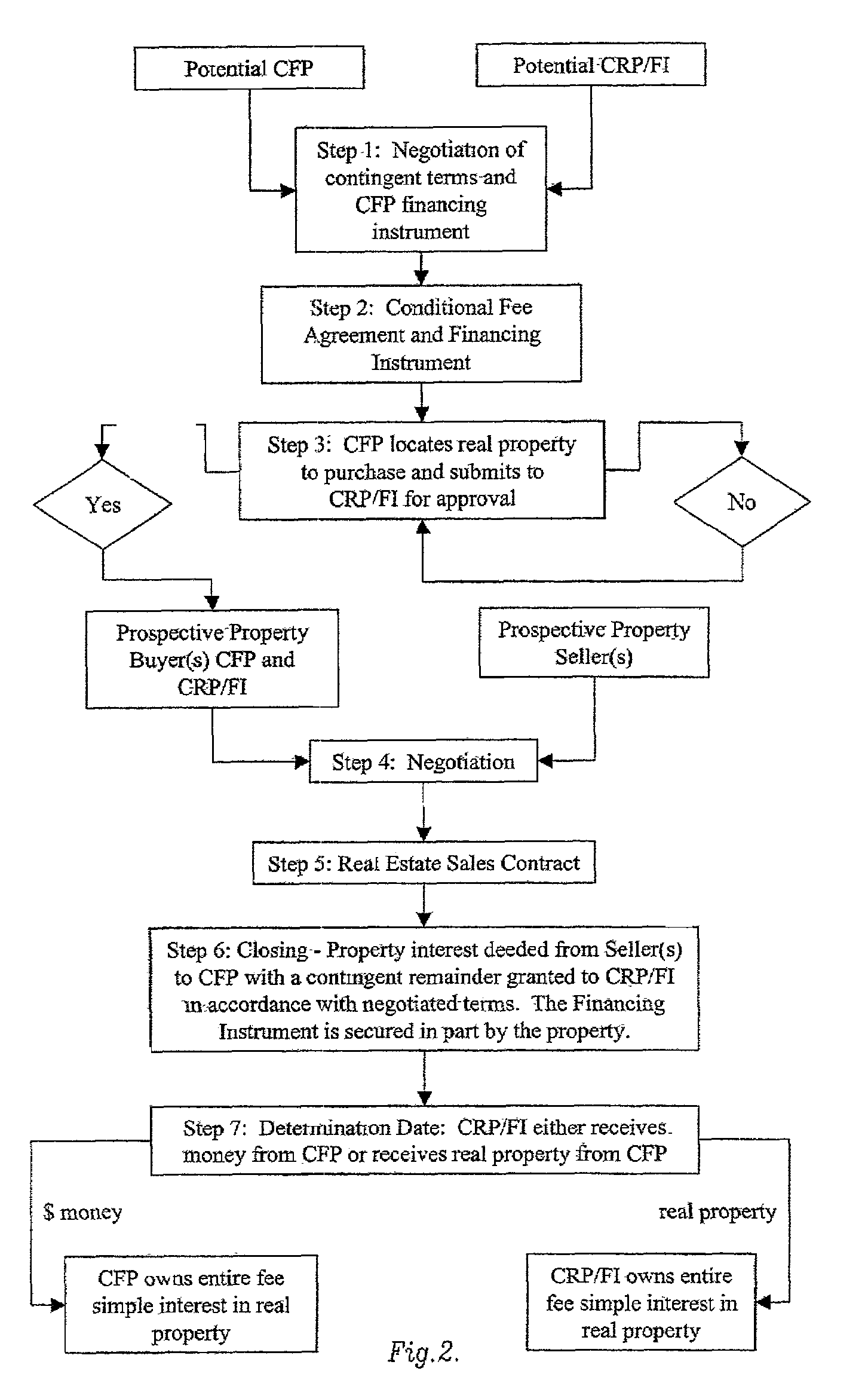

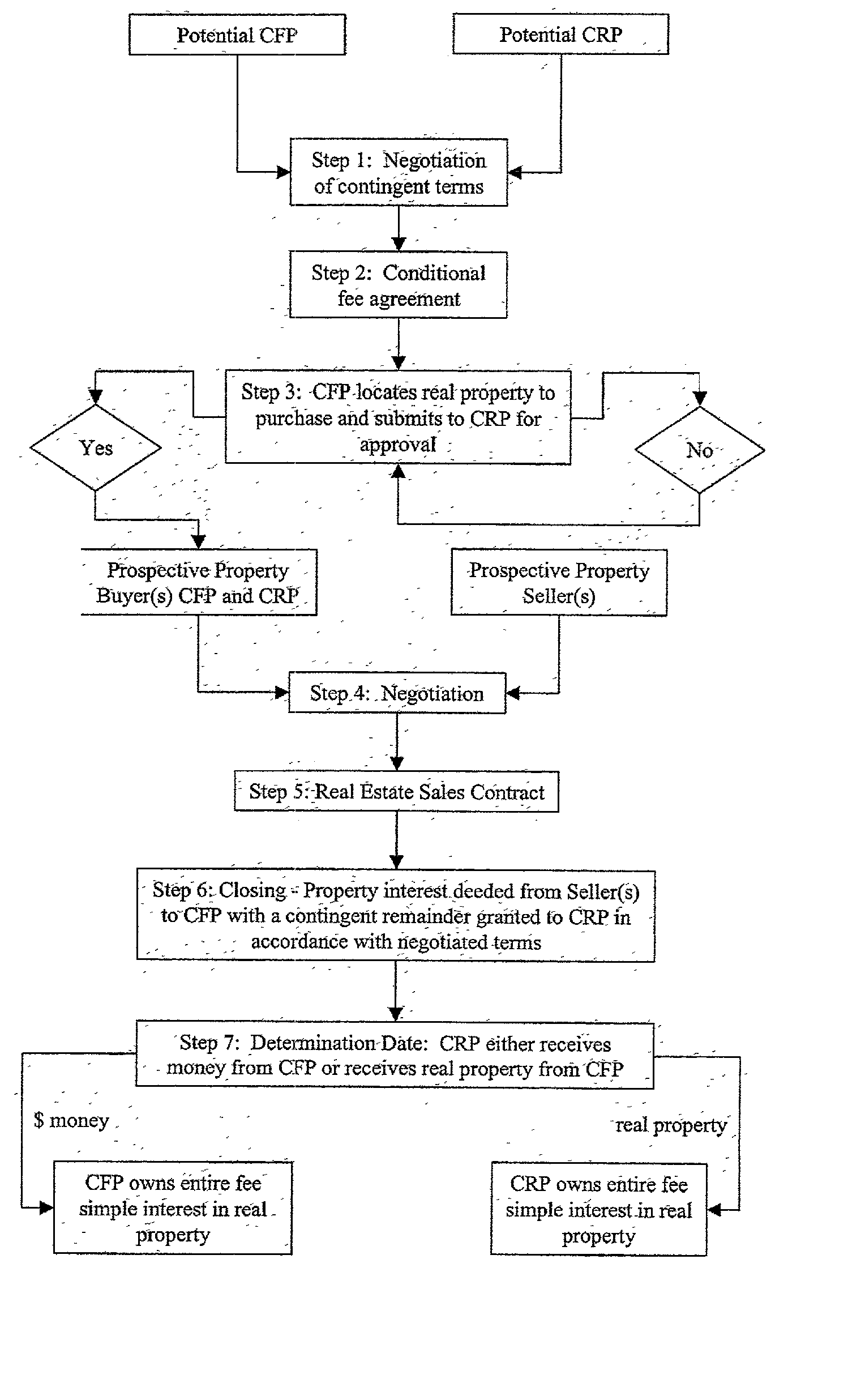

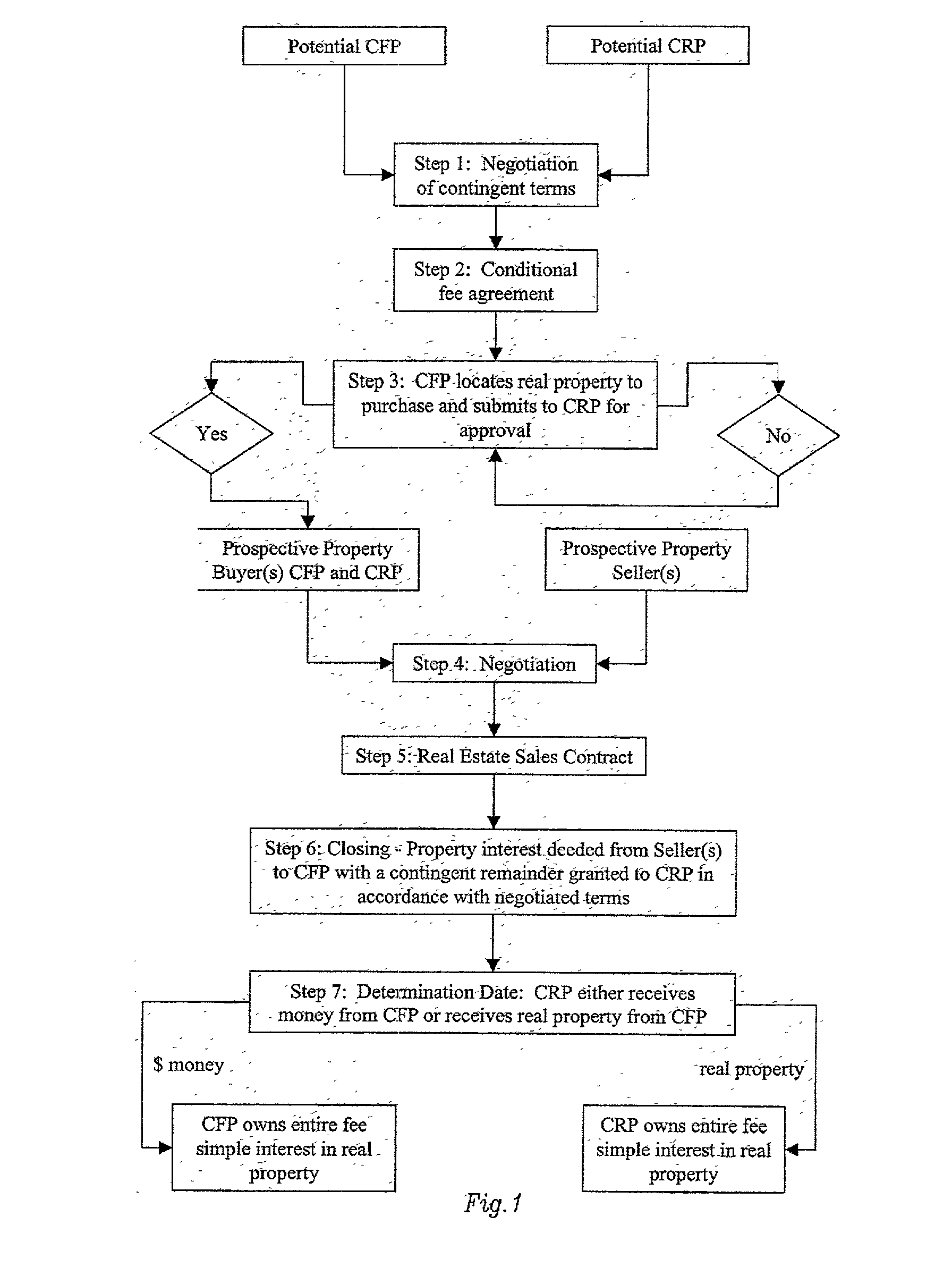

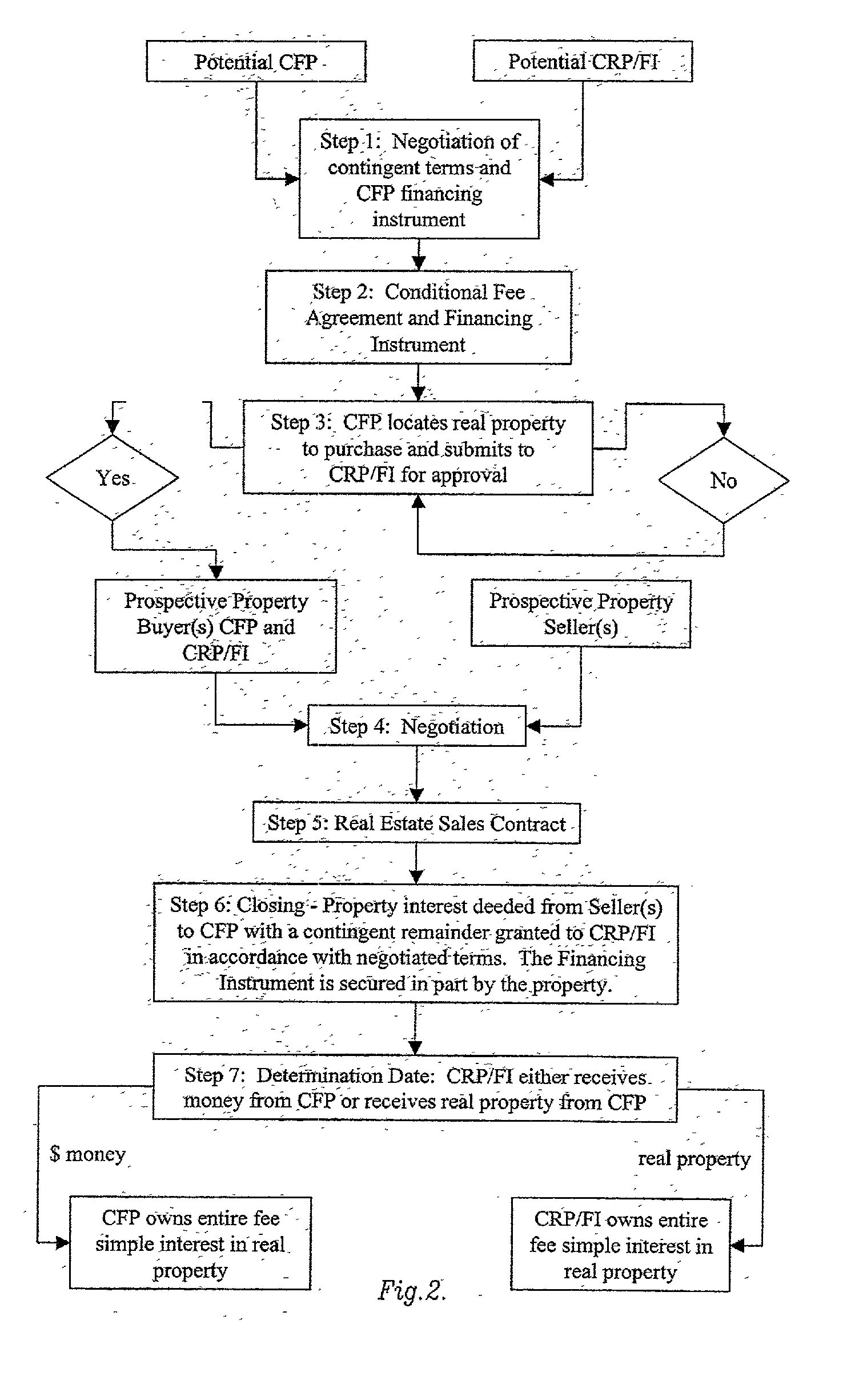

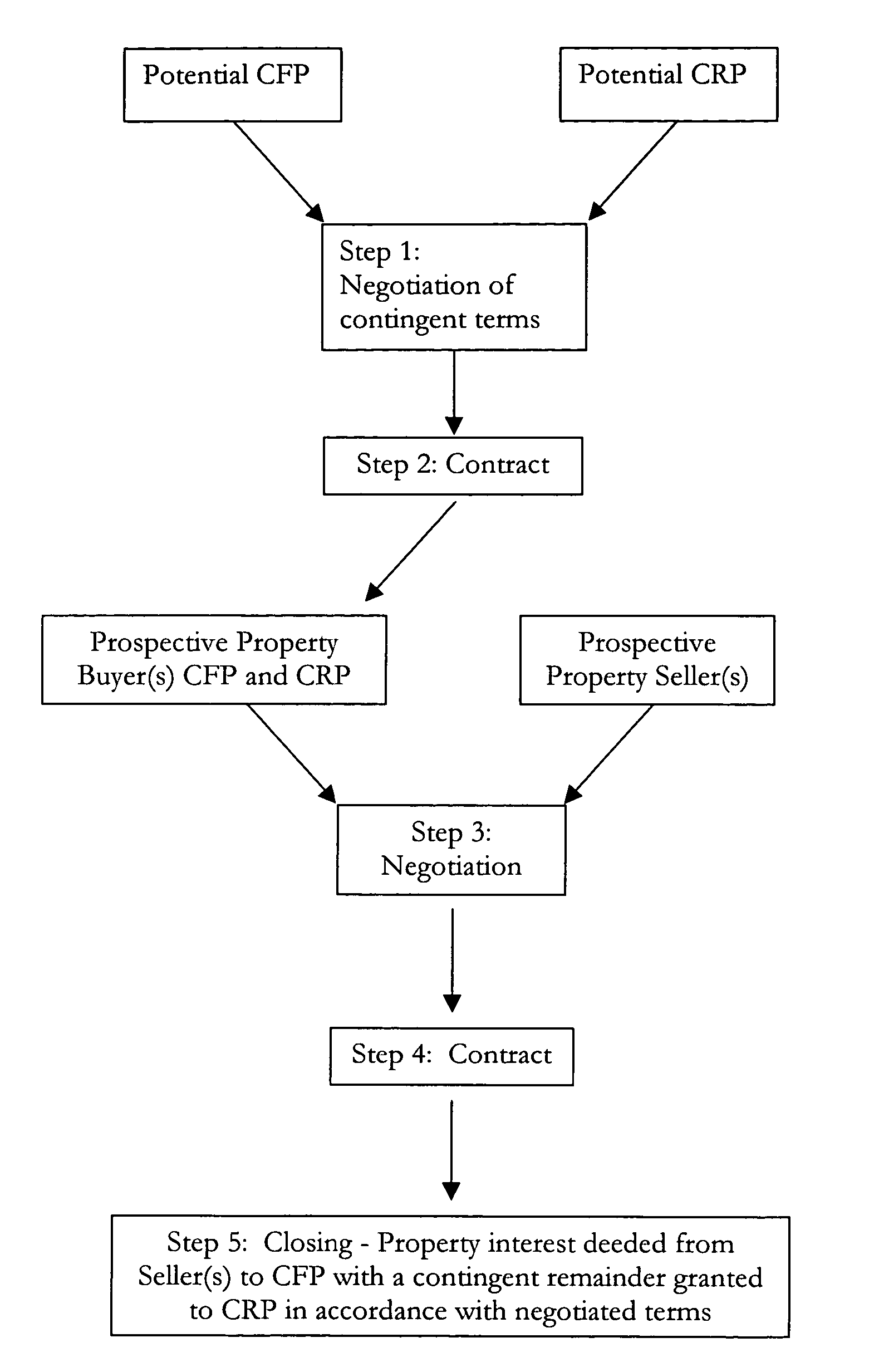

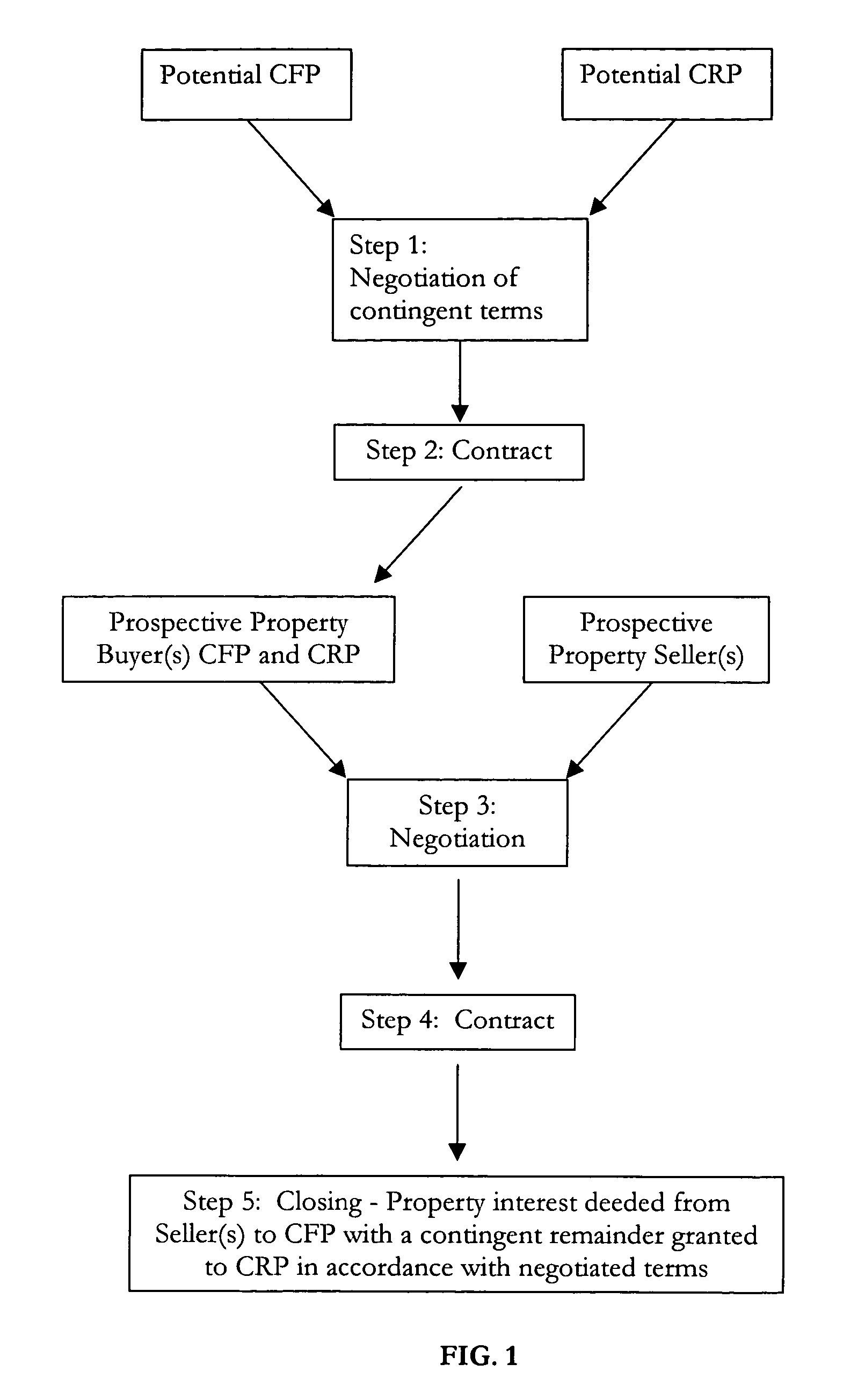

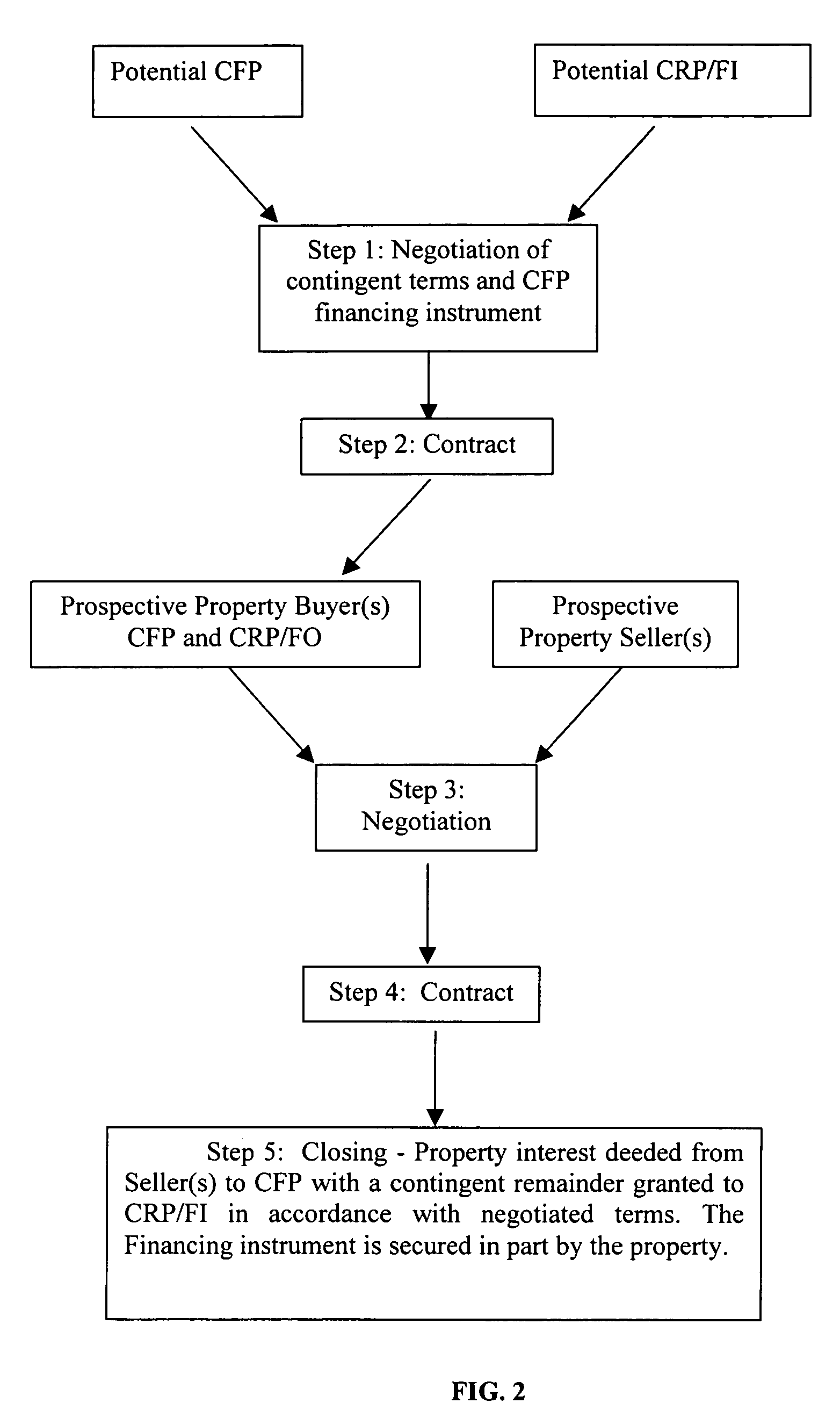

Conditional fee ownership home financing system and business method

A method and system for financing the purchase of real property utilizing a conditional fee simple deed. Under this method a conditional fee purchaser and a conditional remainder purchaser enter into a conditional fee agreement, delineating the rights and responsibilities of each party with regards to the purchase of a residential property. The agreement includes a determination date, at which time, the conditional remainder purchaser will either receive the entire fee simple interest in the property or will receive a lump sum payment from the conditional fee purchaser for the conditional remainder purchaser's interest in the real property. The conditional fee agreement includes a list of conditions under which the property will pass directly to the conditional remainder purchaser prior to the determination date.

Owner:WEEKS STEPHEN M

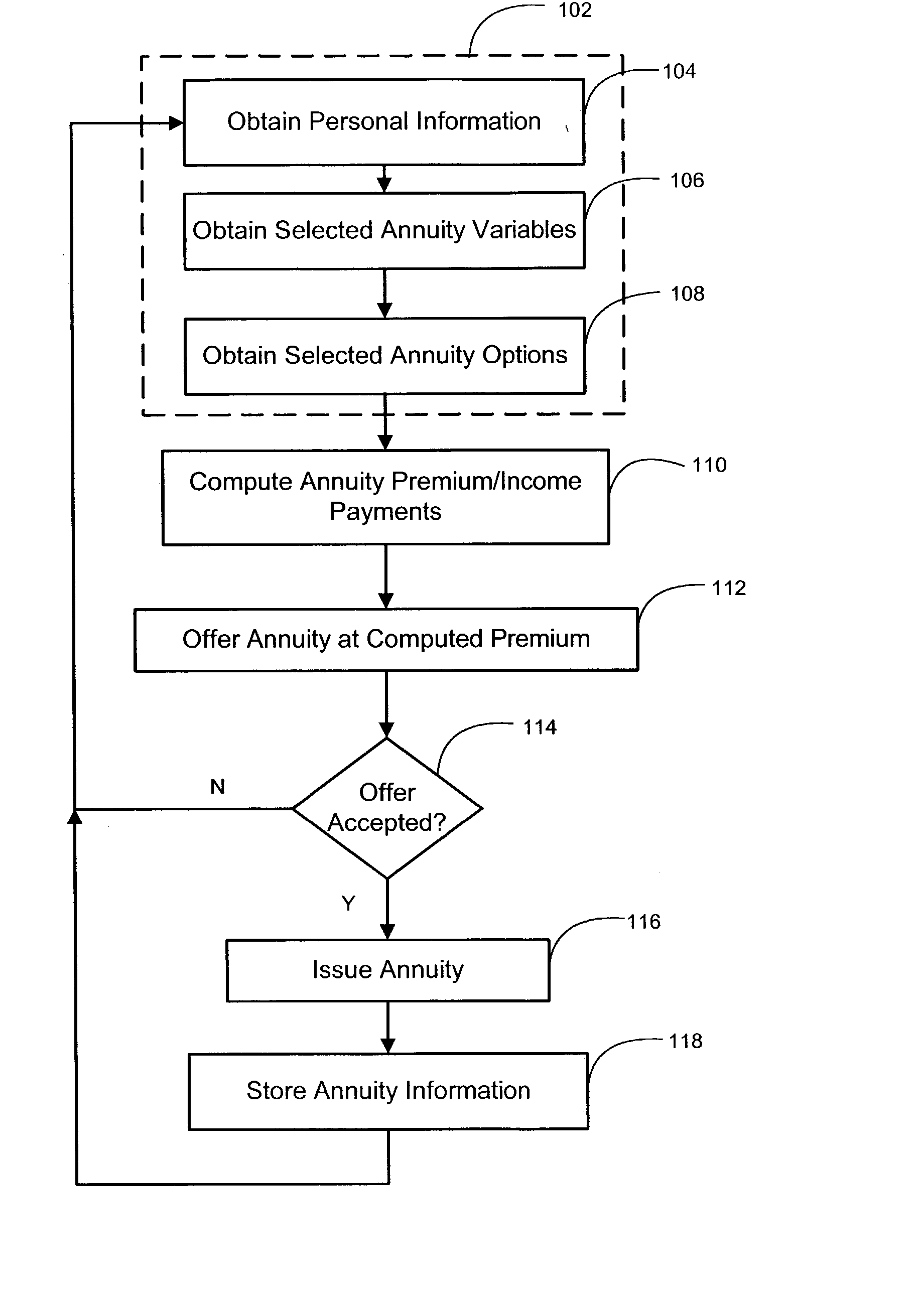

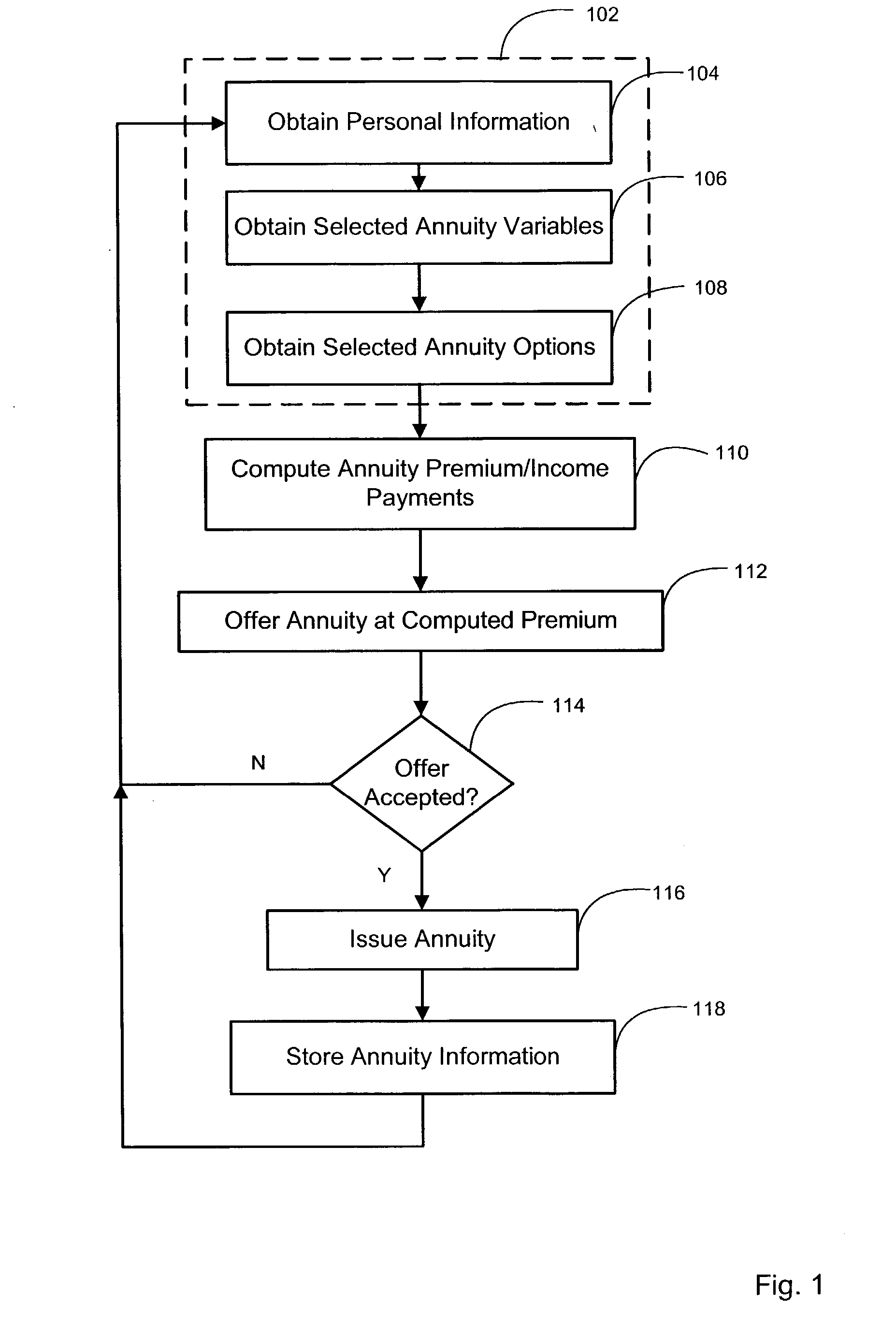

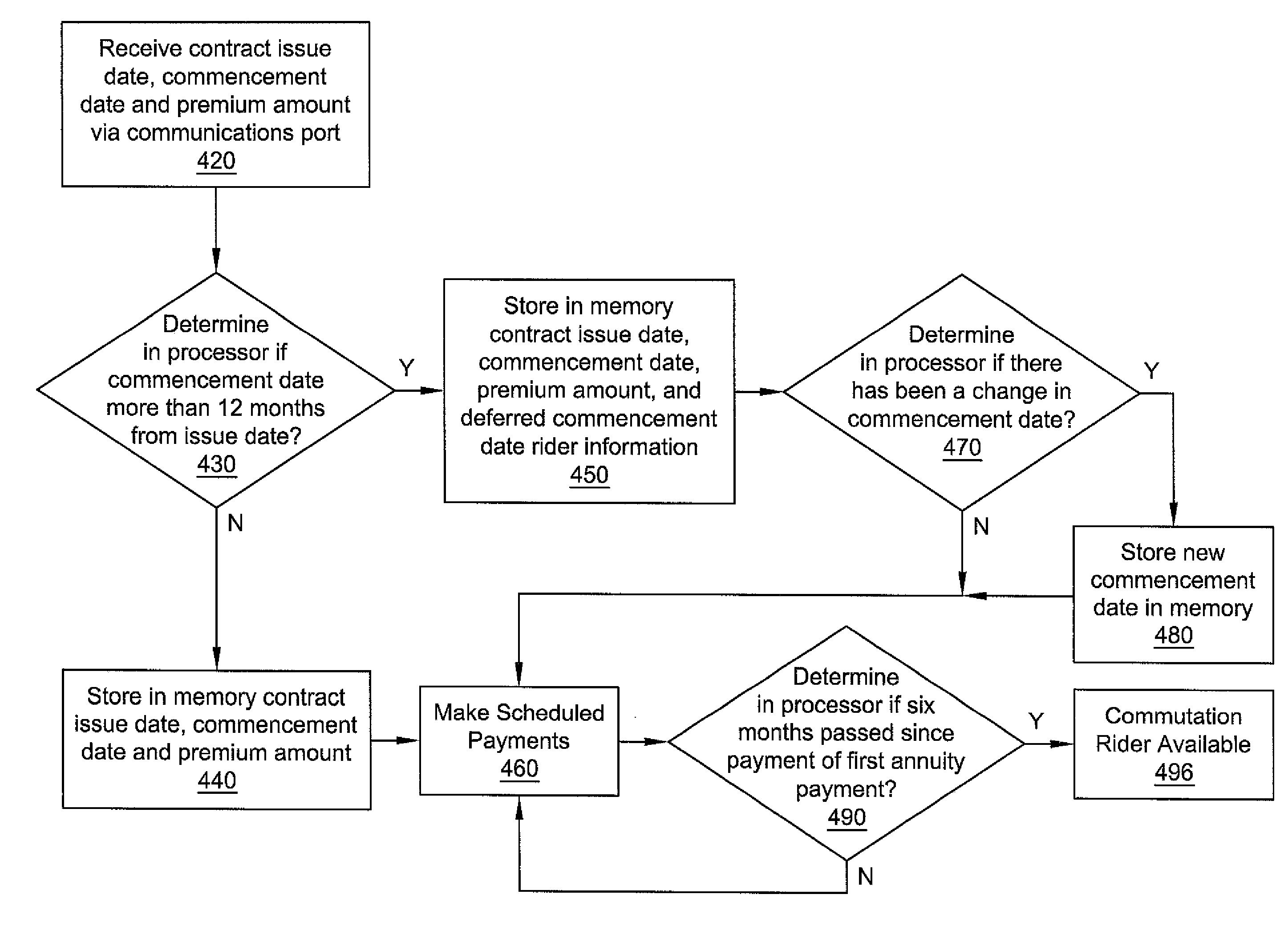

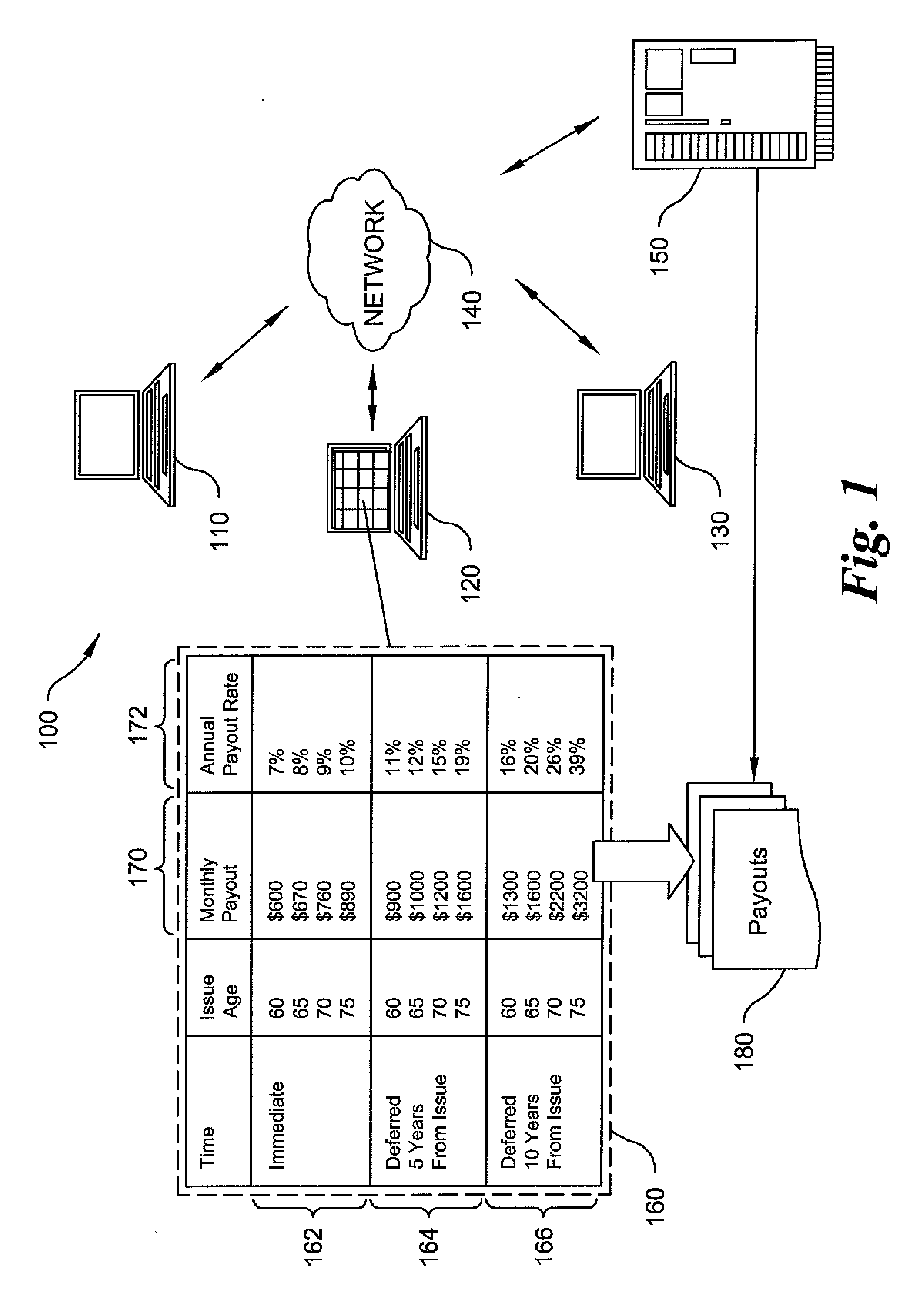

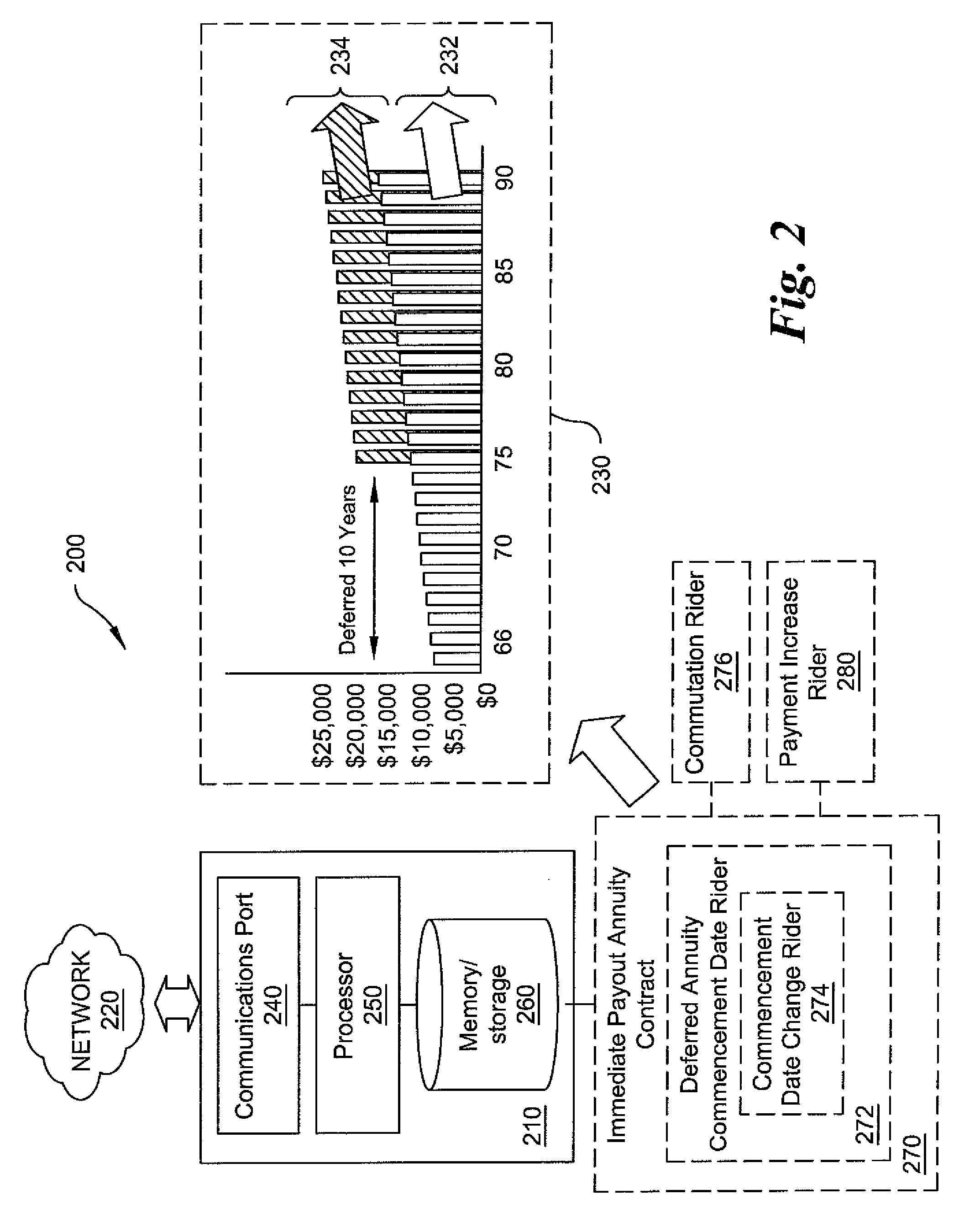

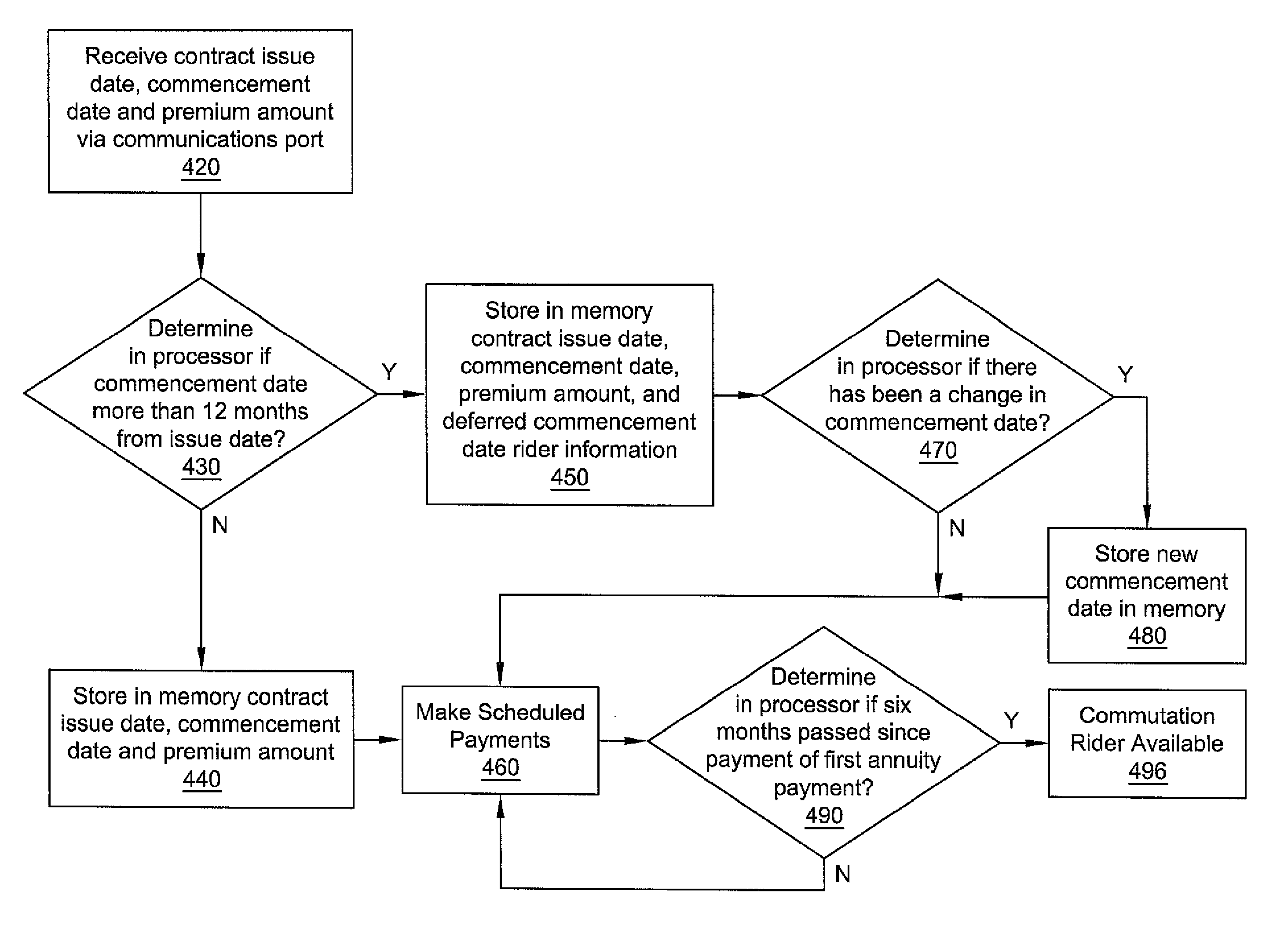

System and method for processing and administering flexible guaranteed income payments

A system is provided for administering fixed income immediate and deferred payments in any of a plurality of different payout schemes selected by a purchaser to accommodate varying retirement income needs. The system can be configured to administer an immediate income annuity where payments start within one year and the system can also administer a deferred payout annuity through a single dual natured payout contract. Additional options available for administration by the system include options to permit the contract owner to change the annuity commencement date and the ability to commute future period certain periodic payments into a single lump sum payment.

Owner:TALCOTT RESOLUTION LIFE INSURANCE CO

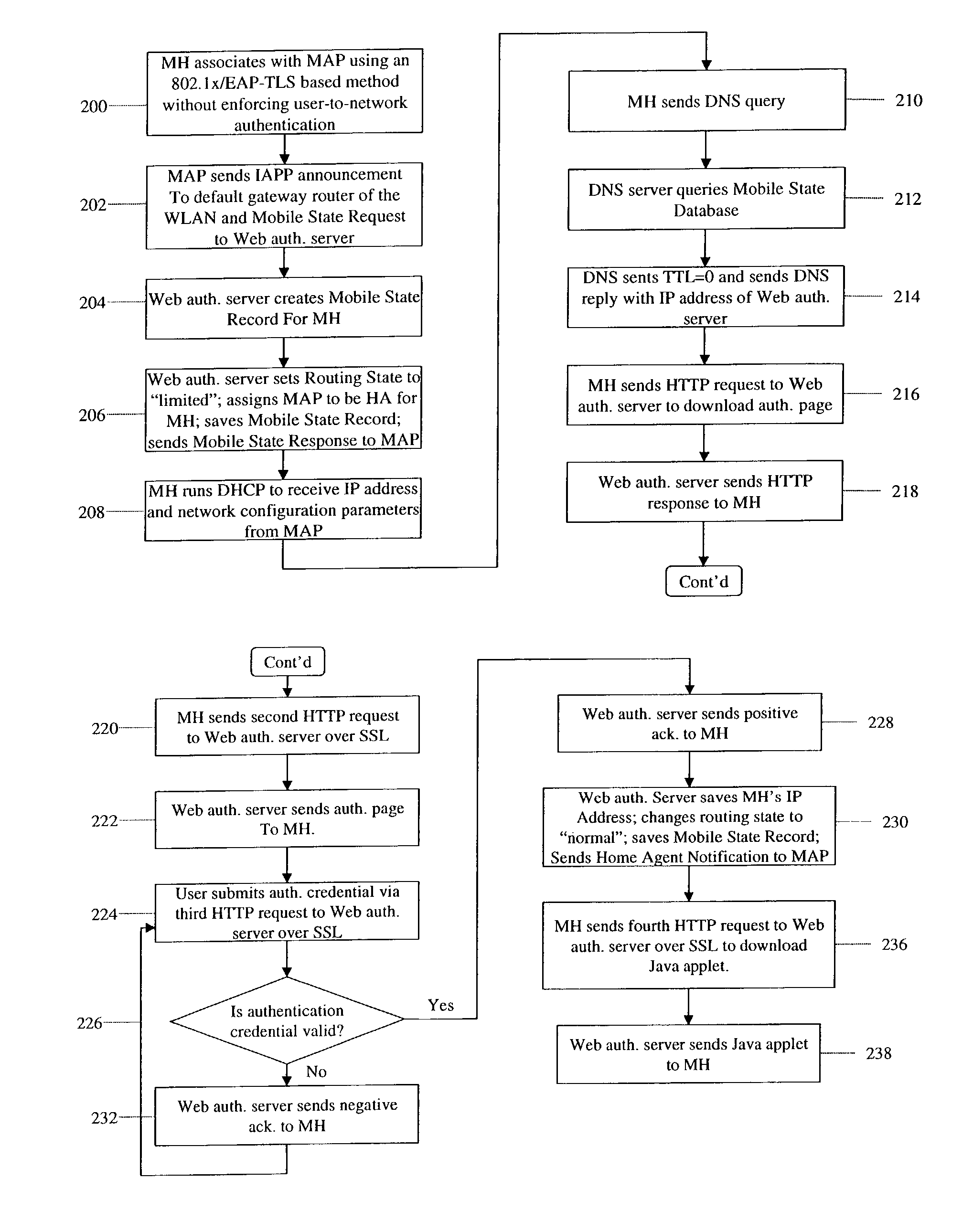

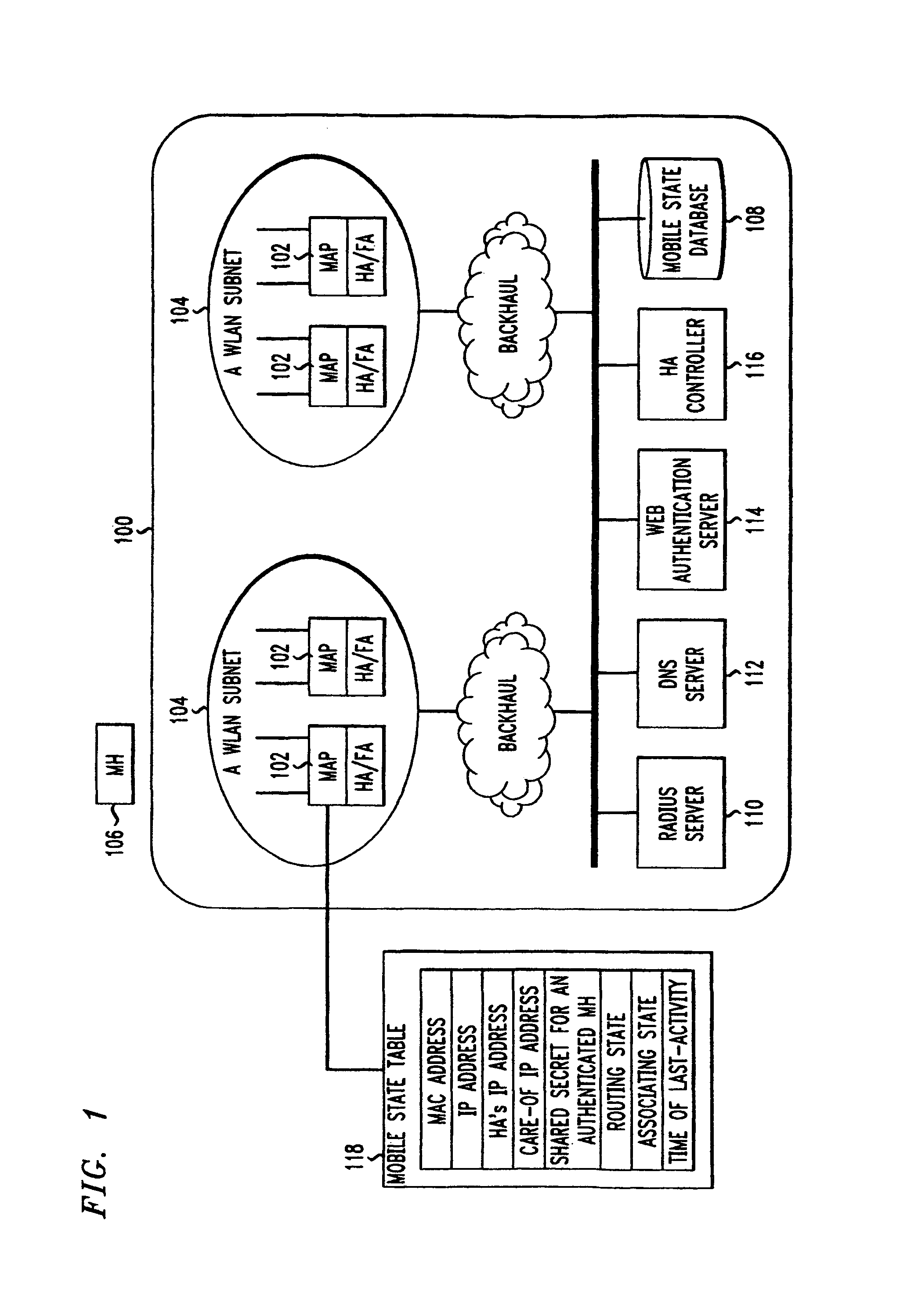

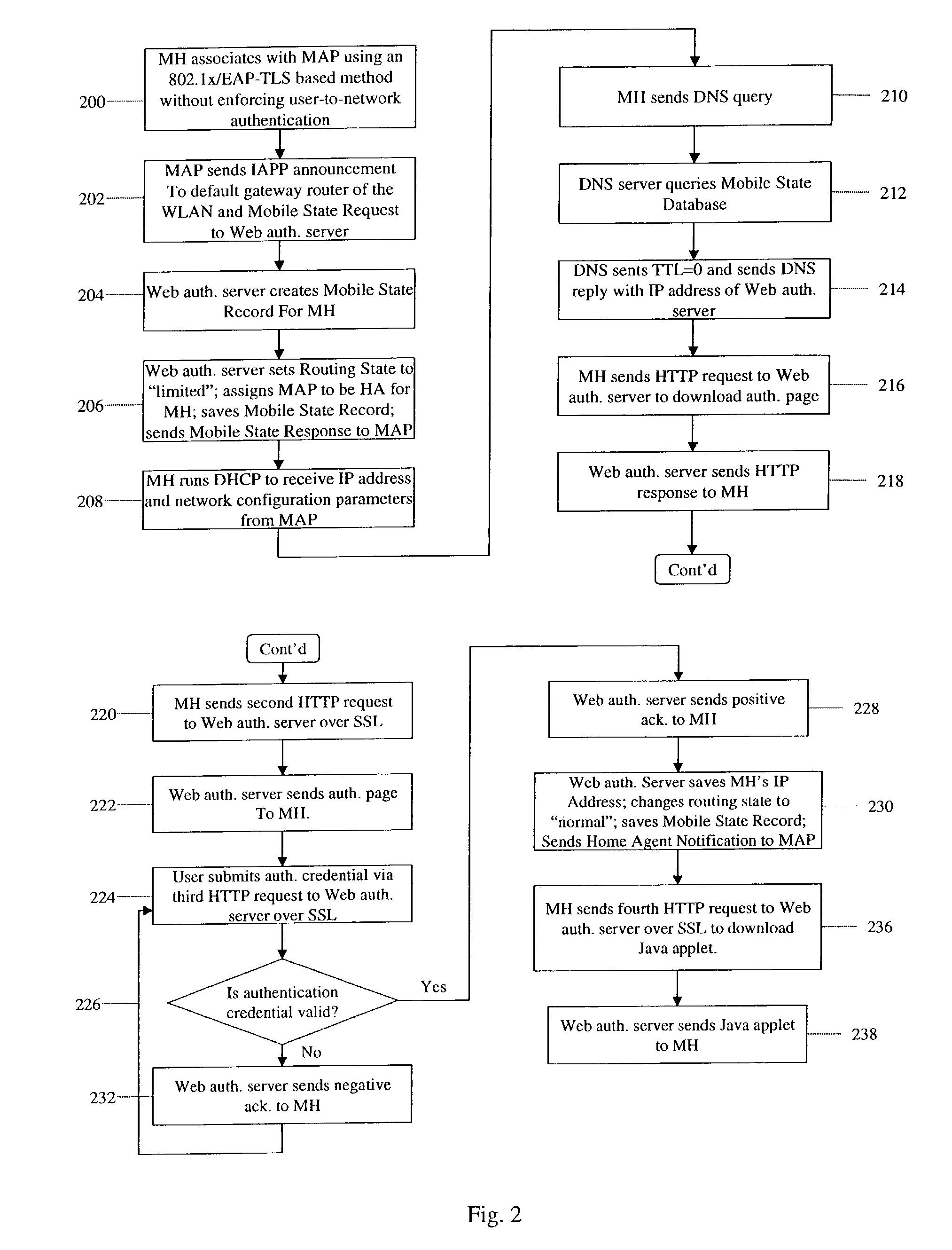

Zero-configuration secure mobility networking technique with web-based authentication interface for large WLAN networks

InactiveUS8817757B2Authentication is convenientAvoid attackNetwork traffic/resource managementNetwork topologiesIp addressUser authentication

A zero-configuration secure mobility networking technique for WLANs is provided, utilizing split link-layer and a Web-based authentication. The link-layer authentication process facilitates network-to-user authentication and generation of session-specific encryption keys for air traffic using digital certificates to prevent man-in-the-middle attacks without requiring users to have pre-configured accounts. Although any WLAN host can pass the link-layer authentication and obtain link connectivity, the WLAN only allows the host to obtain IP networking configuration parameters and to communicate with a Web-based authentication server prior to initiating the Web-based authentication process that is responsible for user-to-network authentication. The Web-based authentication server employs a Web page for initial authentication and a Java applet for consequent authentications. In the Web page, registered users can manually, or configure their Web browsers to automatically, submit their authentication credentials; new users can open accounts, make one-time payments, or refer the Web-based authentication server to other authentication servers where they have accounts. Once a user is authenticated to the WLAN, the user's mobile host obtains full IP connectivity and receives secure mobility support from the WLAN. The mobile host always owns a fixed IP address as it moves from one access point to another in the WLAN. All wireless traffic between the mobile host and the WLAN is encrypted. Whenever the mobile host moves to a new access point, a Java applet (or an equivalent client-side program delivered over Web) enables automatic authentication of the mobile host to the WLAN. In addition, the ZCMN method supports dynamic load balancing between home agents. Thus, a mobile host can change home agents during active sessions.

Owner:AMERICAN TELEPHONE & TELEGRAPH CO

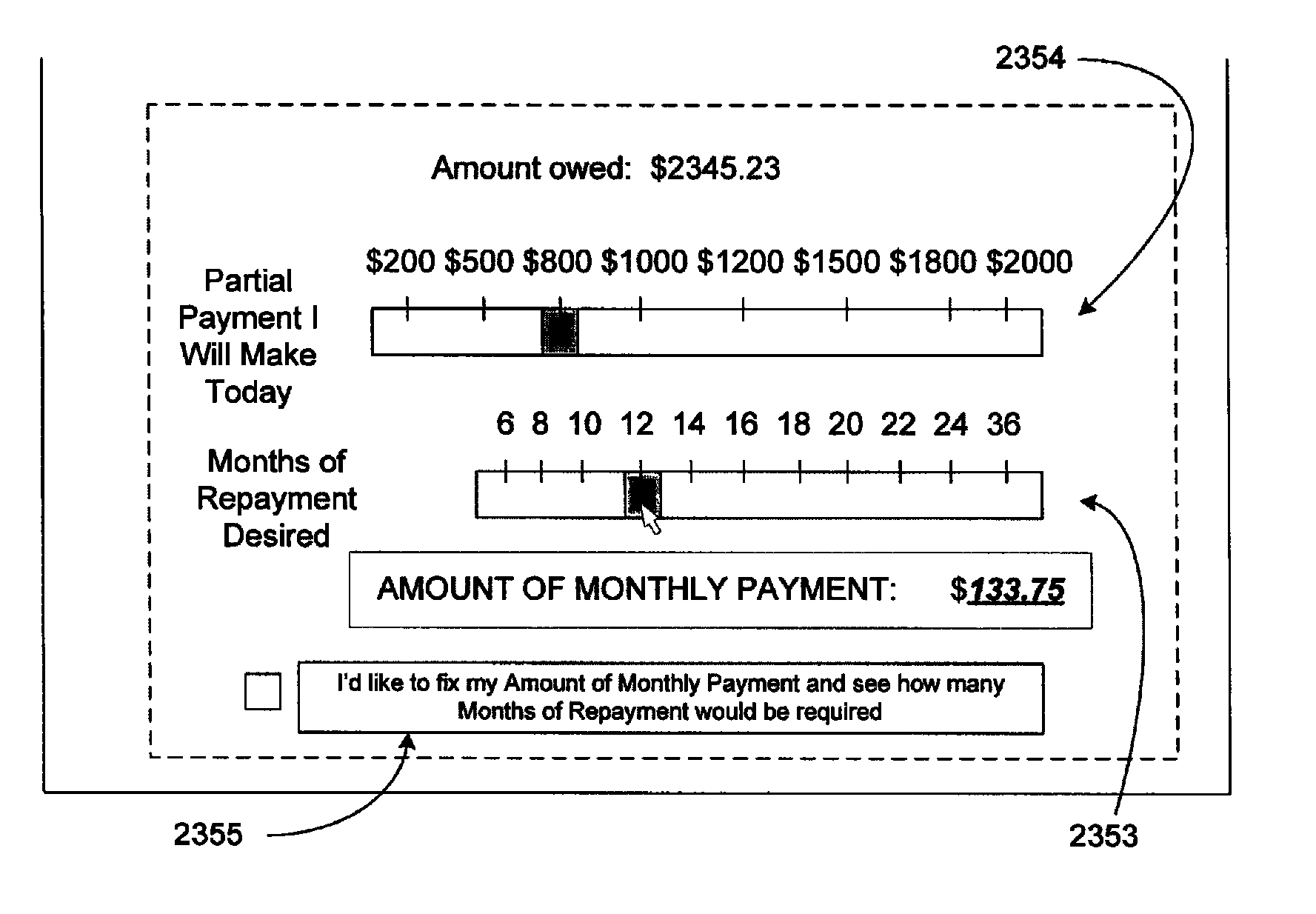

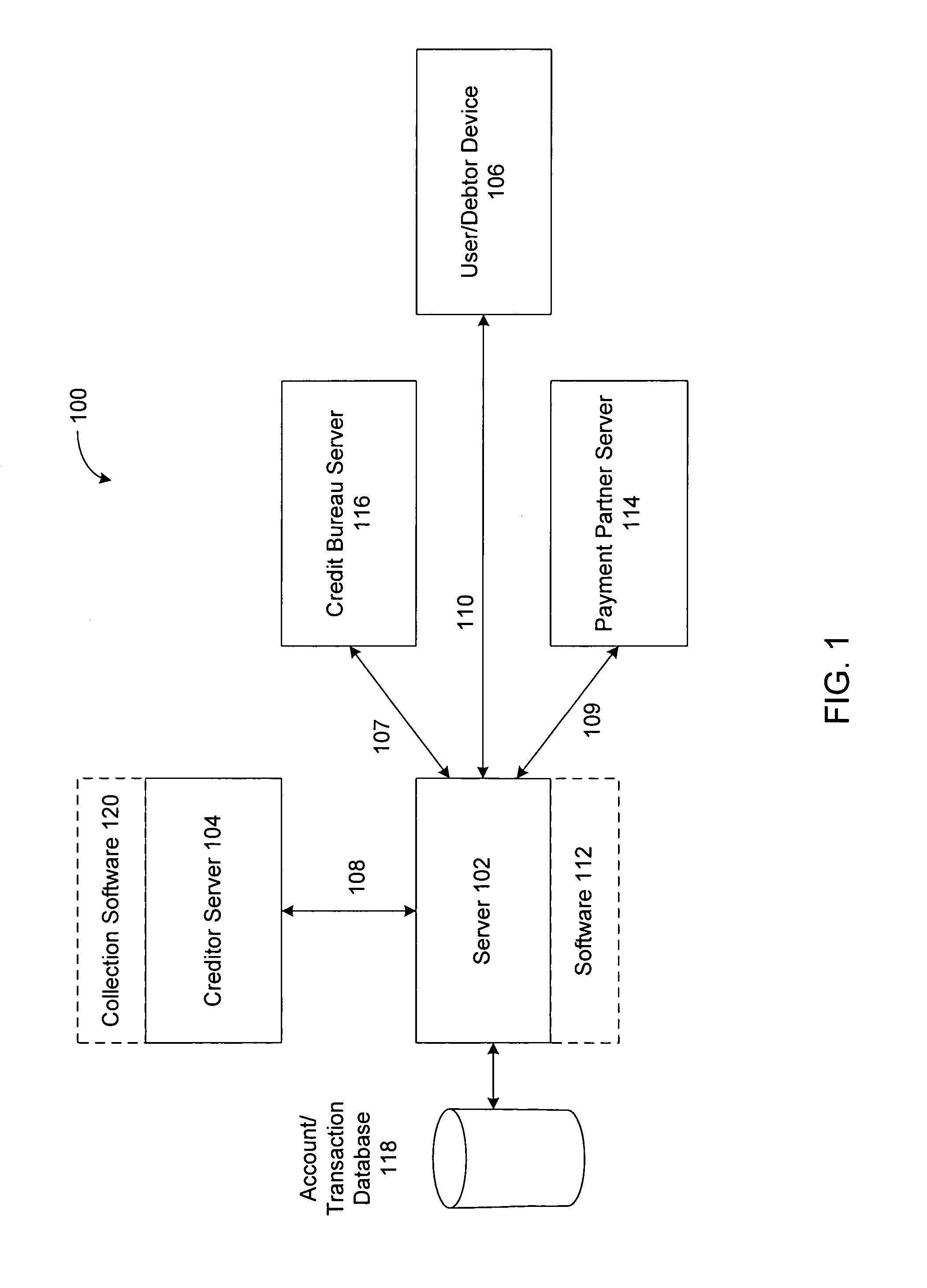

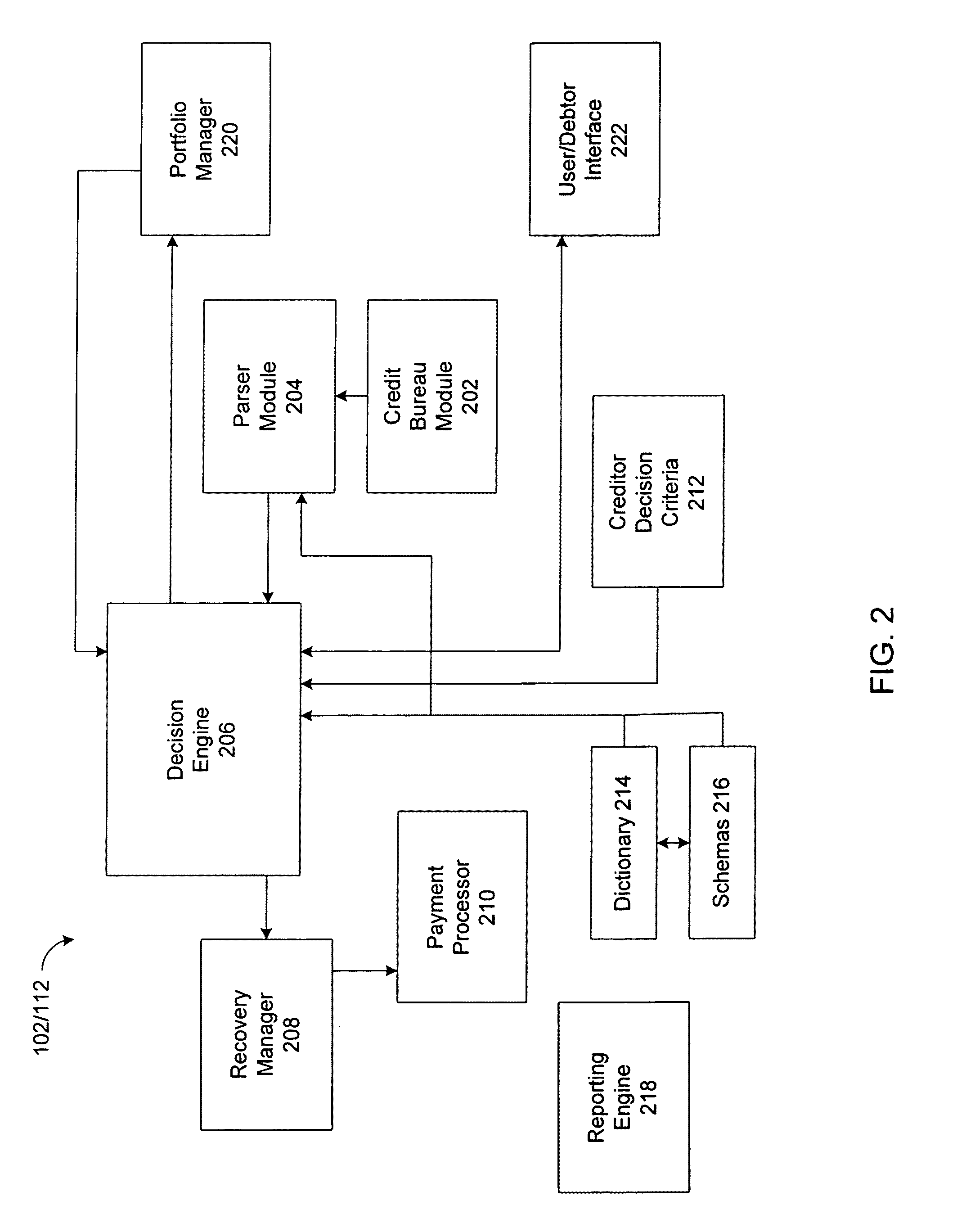

System and method for resolving transactions with lump sum payment capabilities

A system and method for the online settling of a transaction is provided. The system includes a server having a rules based engine including rules established on behalf of a party to the transaction, such as a creditor. The rules based engine is configured to process data and present a transaction settlement offer set comprising a plurality of selectable offers to the user based on at least one decision made by the rules based engine. The server is further configured to receive a lump sum payment proposal from the user and to use the rules based engine to process information comprising the lump sum payment proposal and present a second transaction settlement offer set to the user based at least in part on the lump sum payment proposal from the user.

Owner:MIRITZ INC

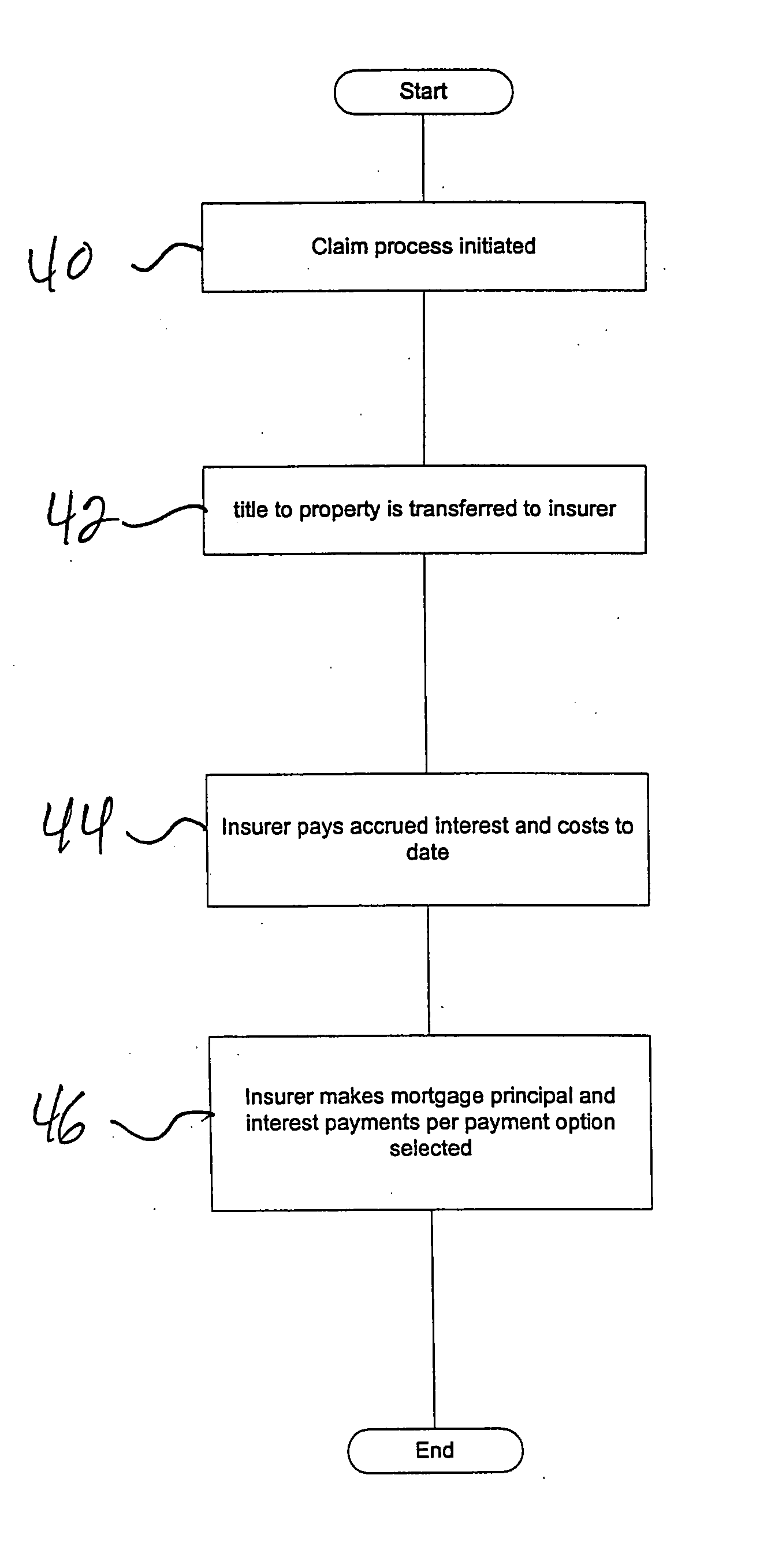

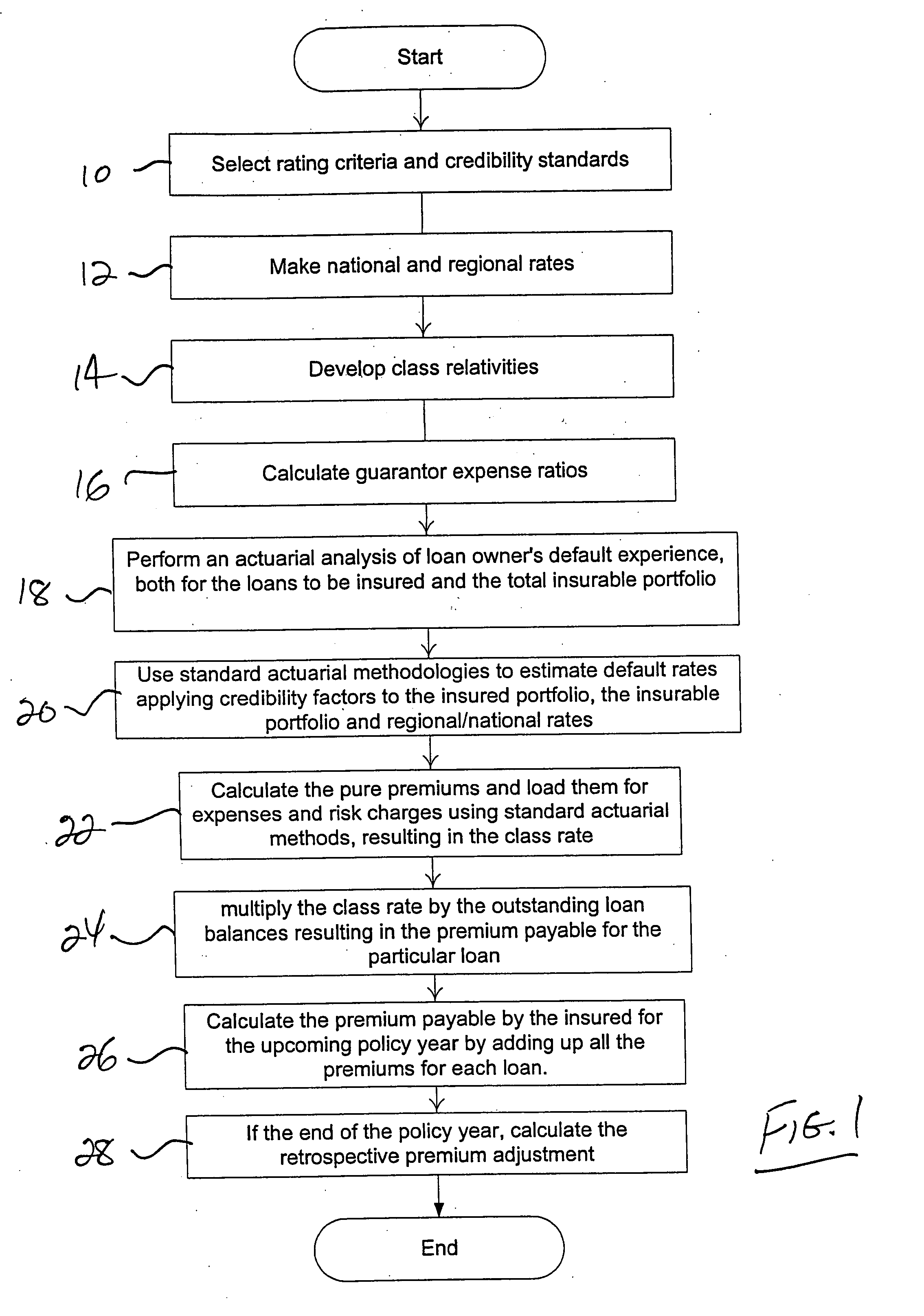

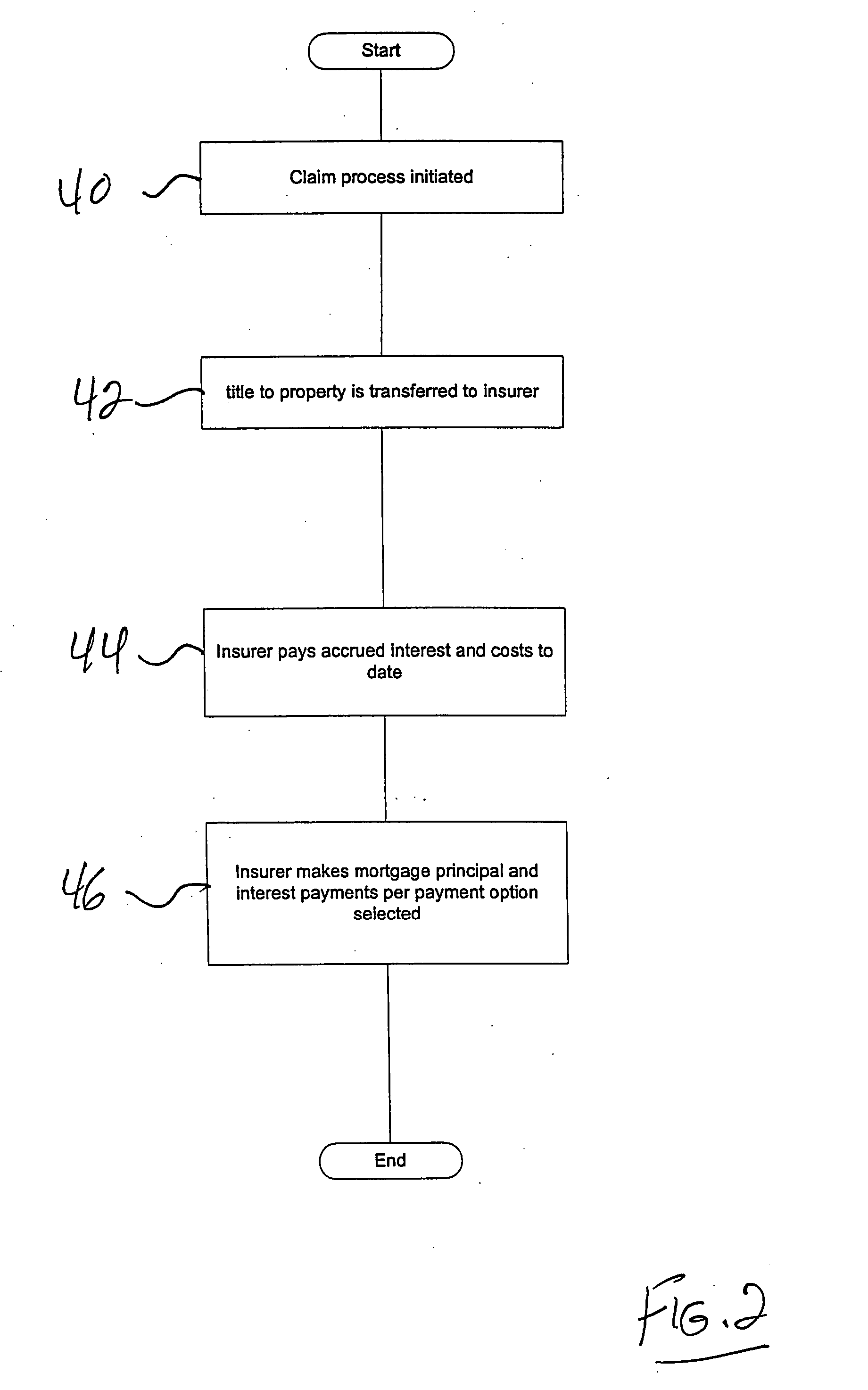

System and method for managing renewable repriced mortgage guaranty insurance

A mortgage guaranty insurance policy is described having periodically adjusted premiums, the determination of said premiums being partially based on loan seasoning; and a claim settlement option chosen from the following: immediate lump-sum settlement, principal and interest payments being maintained for a fixed period prior to loan payoff, principal and interest payments being maintained until loan payoff is demanded by insured, principal and interest payments until the loan is paid off by the insurer. In one embodiment, the premium paid by the lender comprises the sum of individual premiums assigned to each loan in the insured portfolio, and each of said individual premiums are each adjusted according to separate fixed schedules. In another embodiment, the premium paid by the lender comprises the sum of individual premiums assigned to each loan in the insured portfolio, and said individual premiums are adjusted according to the same fixed schedule. In another embodiment, at least one premium adjustment includes a retrospective portion.

Owner:HERZFELD THOMAS +1

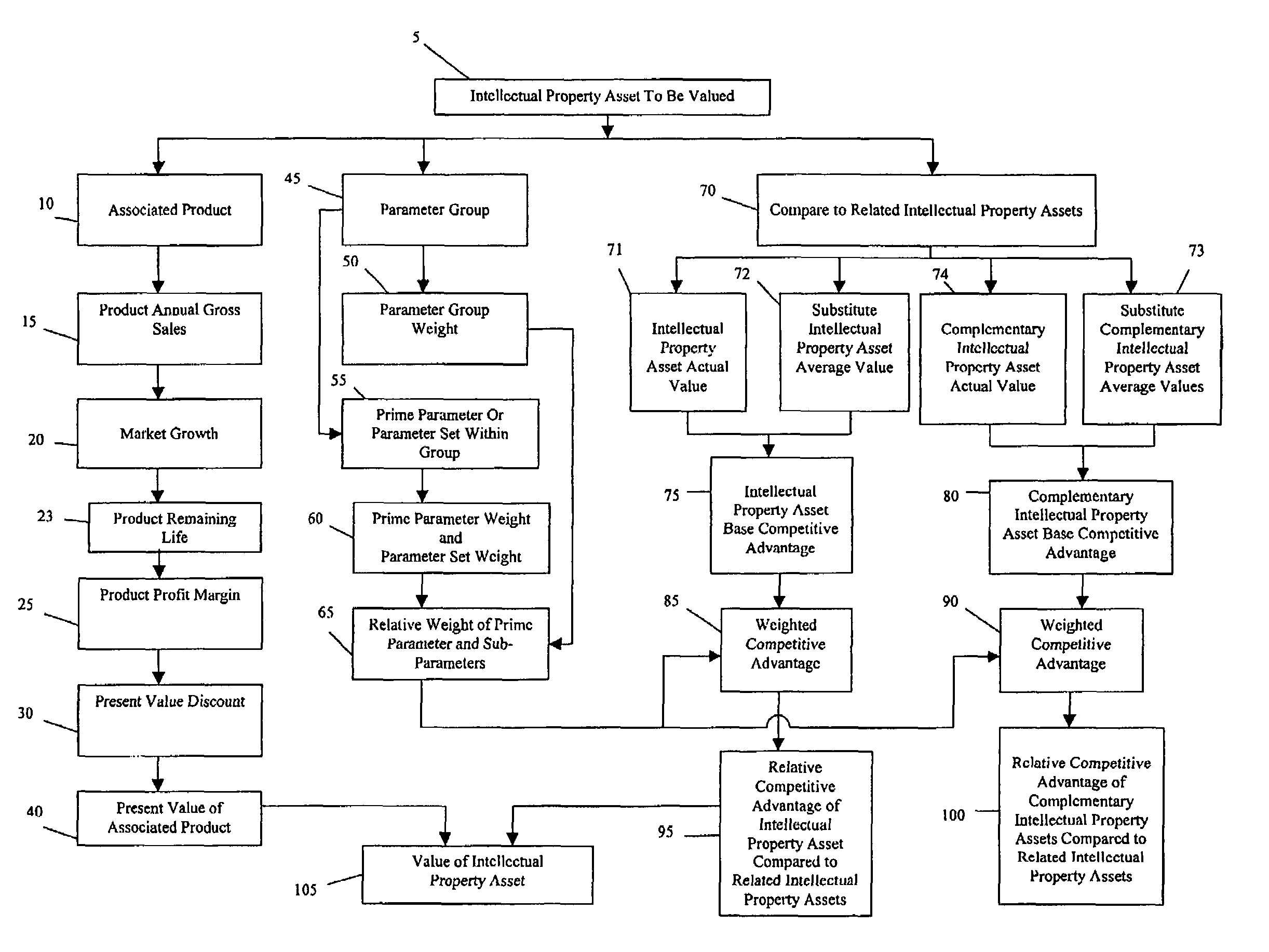

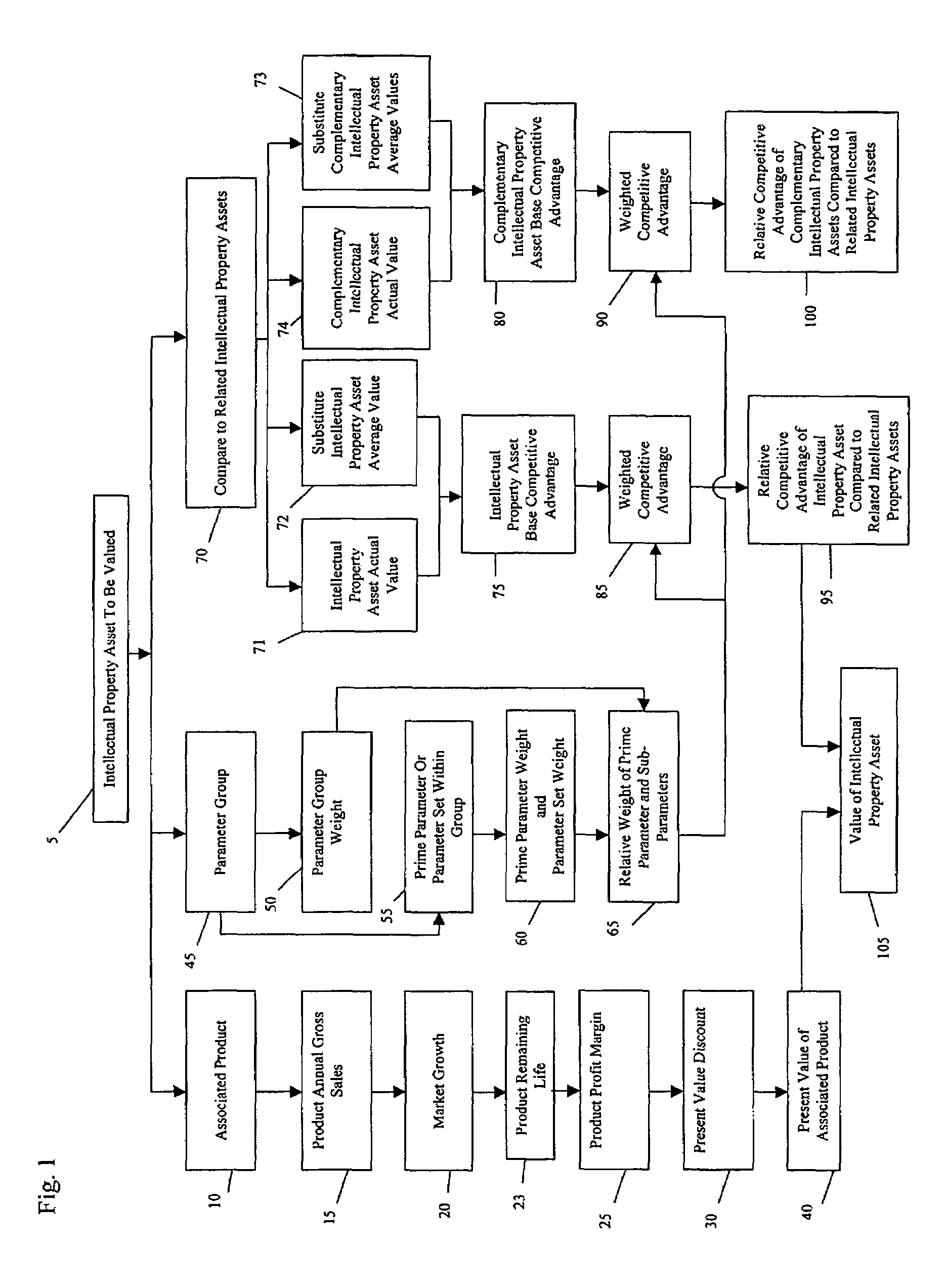

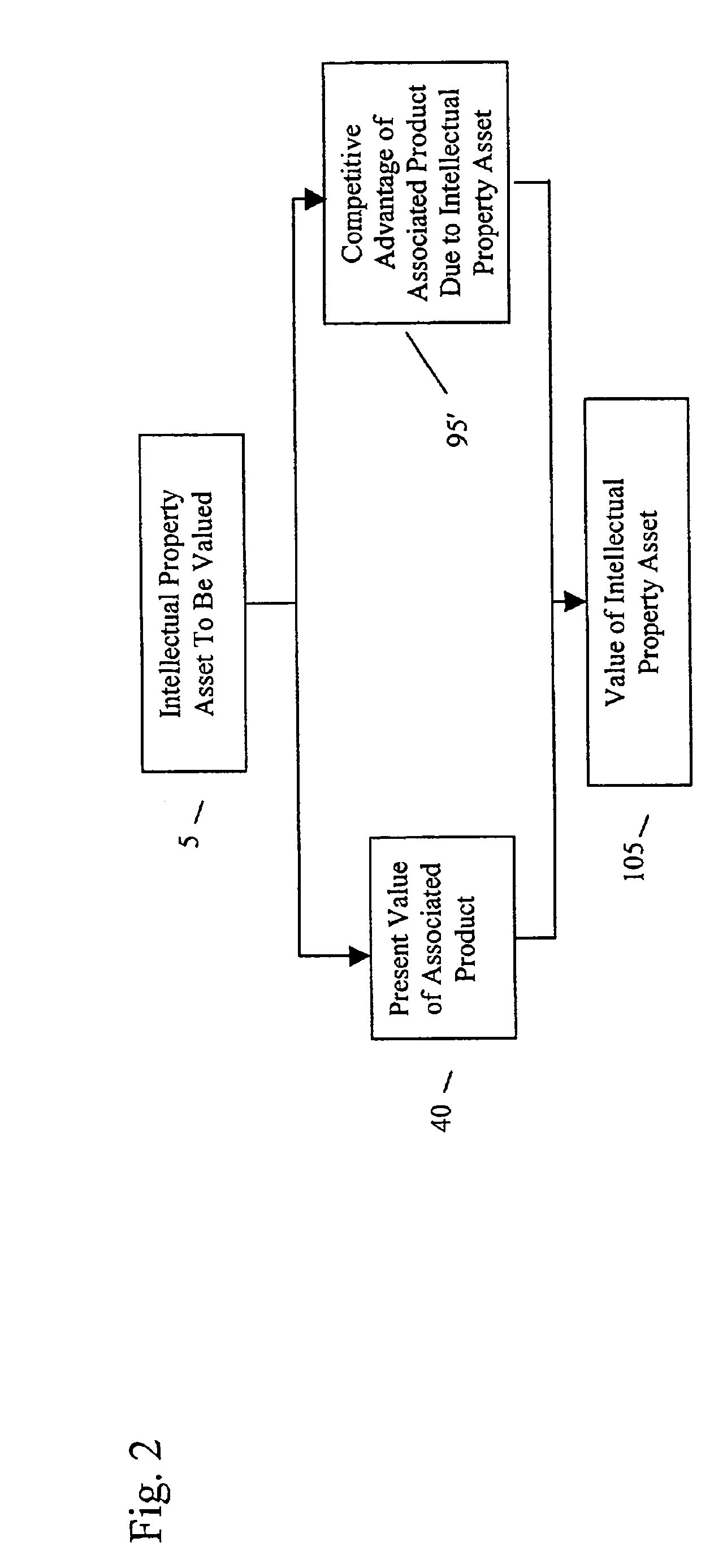

Method for valuing intellectual property

InactiveUS7493262B2Different typeDifferent from valueFinanceMarketingIntellectual propertyComputer science

A computer based system and method for calculating the value of a license for an intellectual property asset between a licensor and a licensee based on the licensor and licensee investment in the license, as well as the predicted increase in product value due to the change in competitive advantage afforded by the intellectual property asset that is the subject of the license. The value of the license may be discounted to adjust for various risks or adjusted based on whether the license is exclusive, limited exclusive, or non-exclusive. The system and method calculates an equal return payment which represents the value of either a one-time, lump-sum payment or the present value of a royalty stream distributed over the lifetime of the intellectual property asset, the system and method of the present invention can place a discrete monetary value on an intellectual property asset.

Owner:SYRACUSE UNIVERSITY

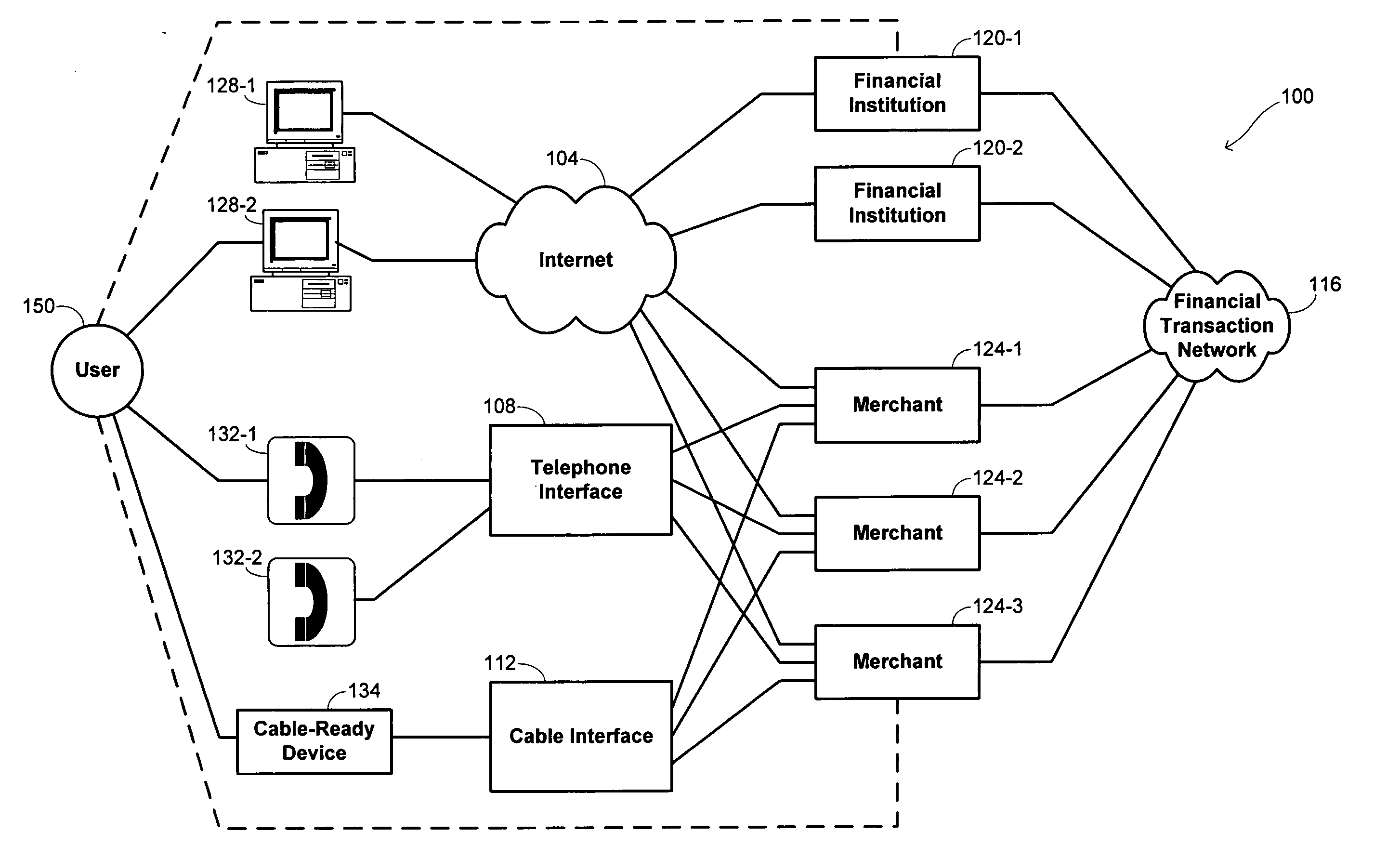

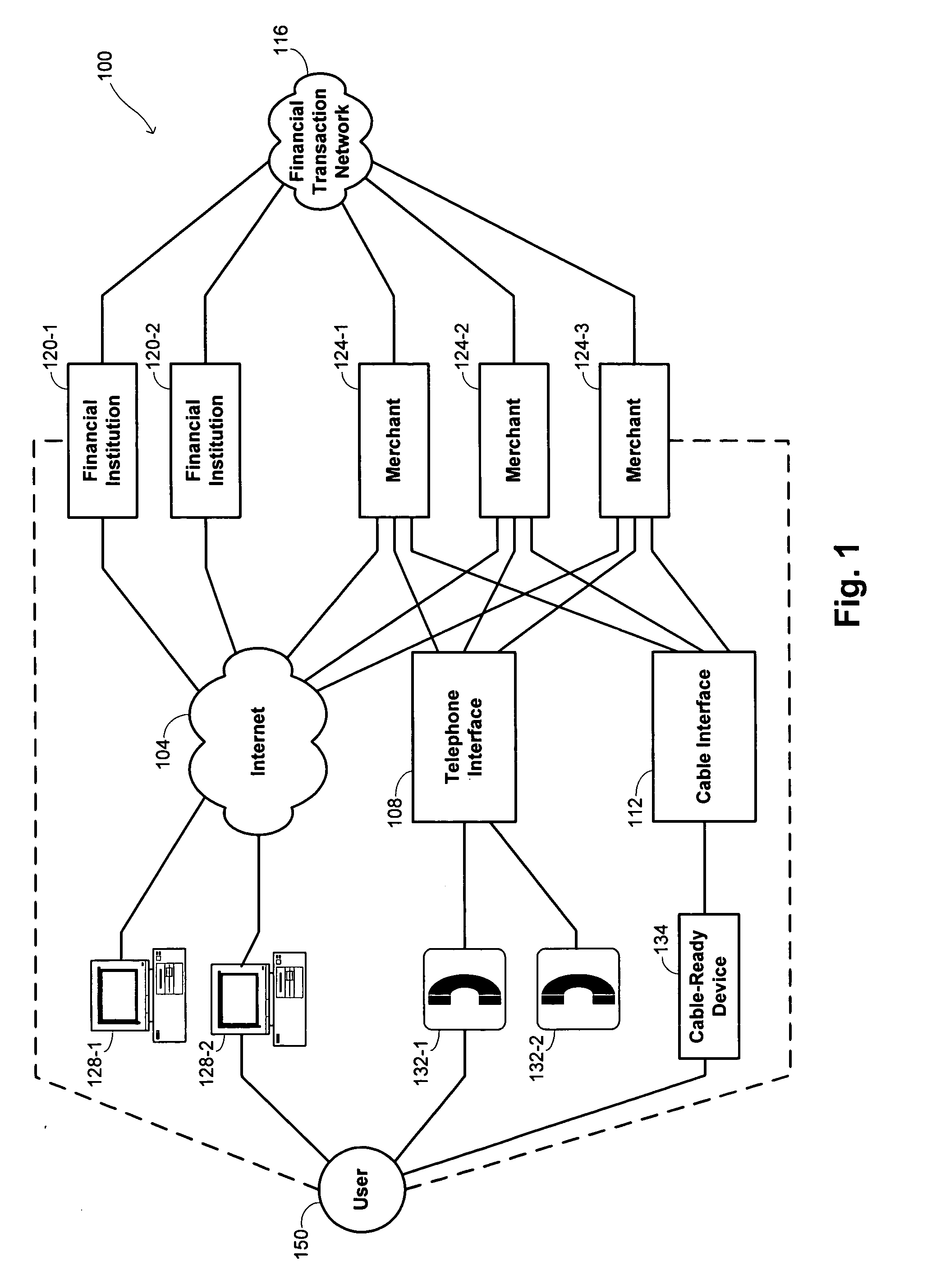

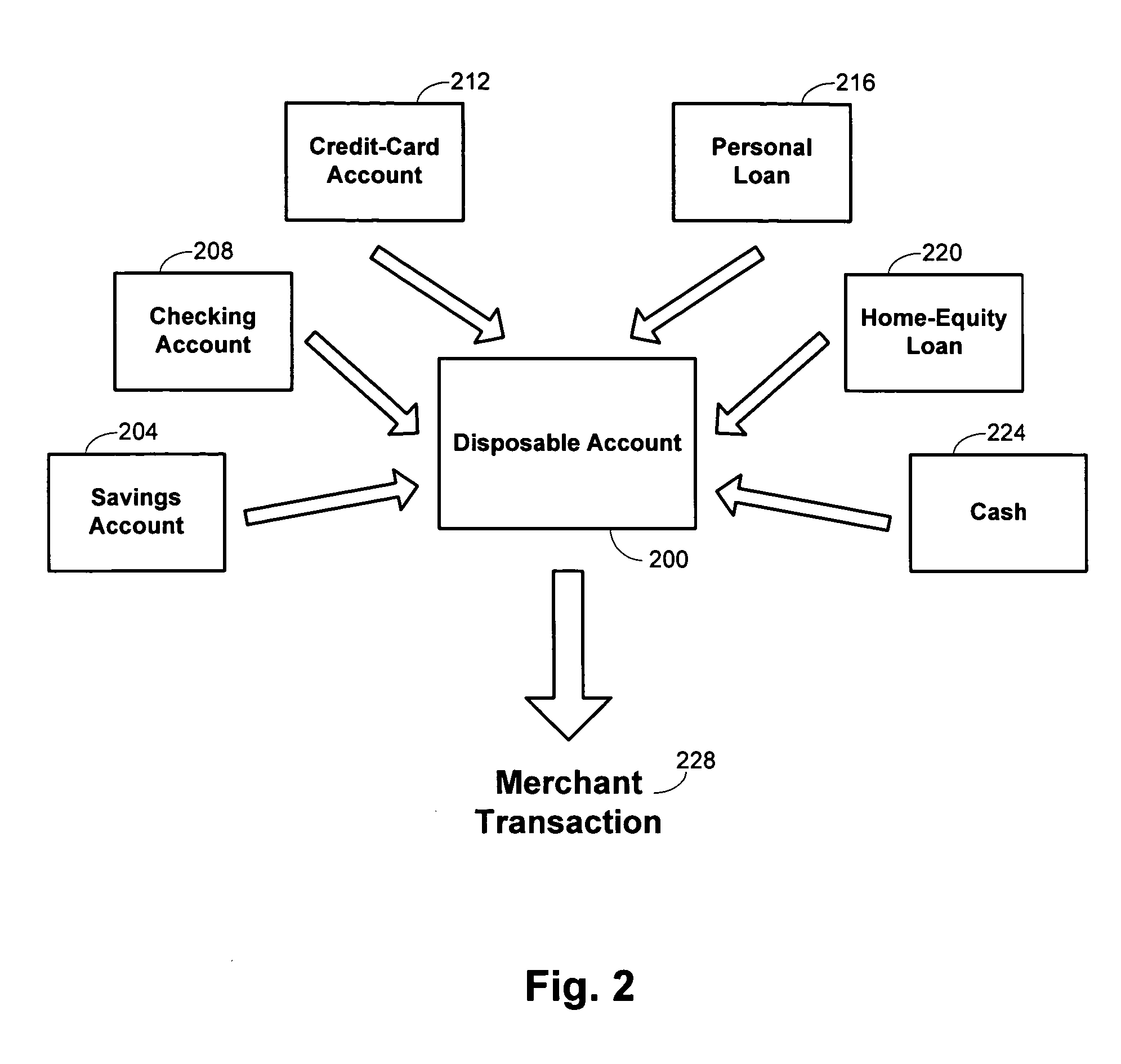

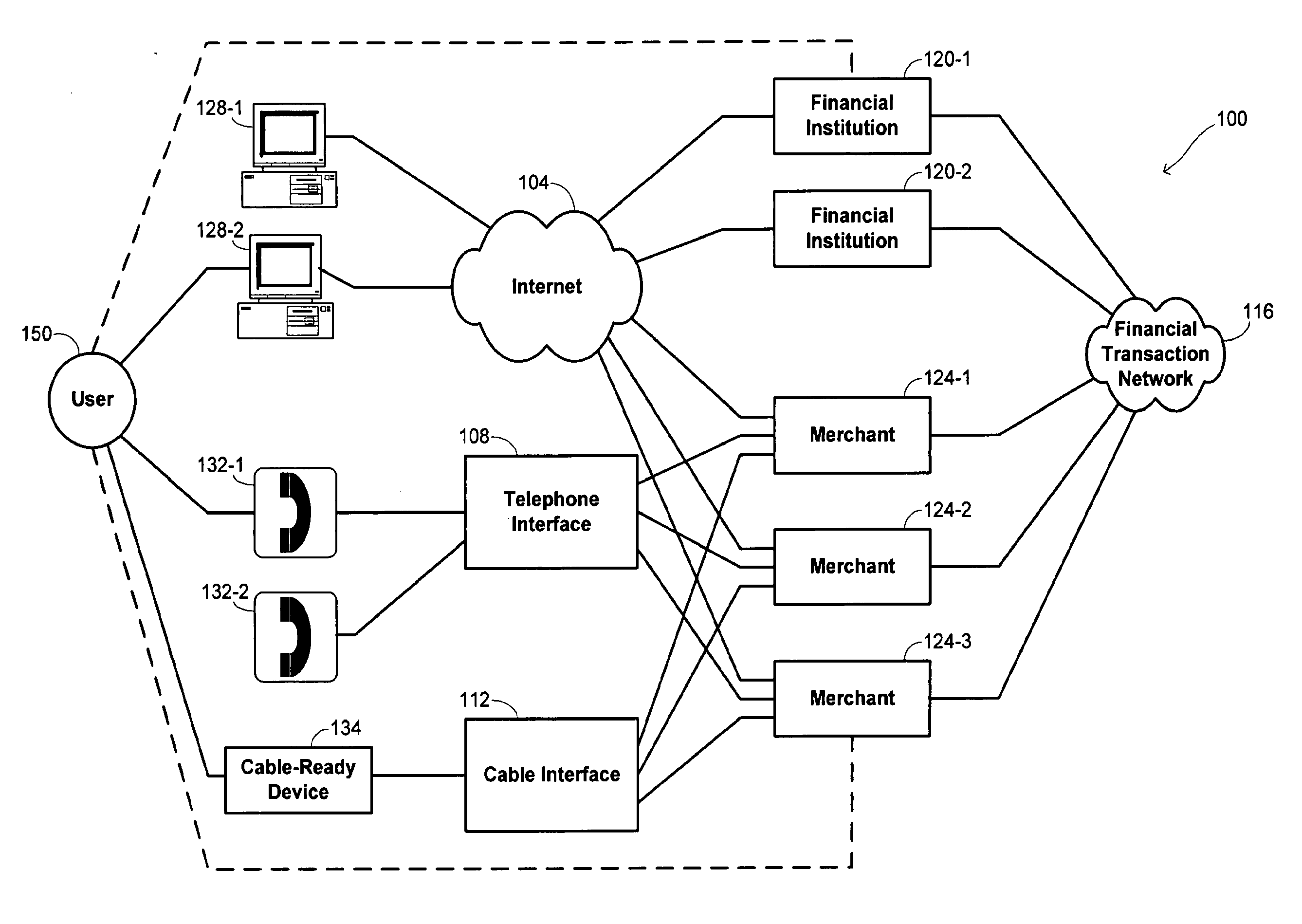

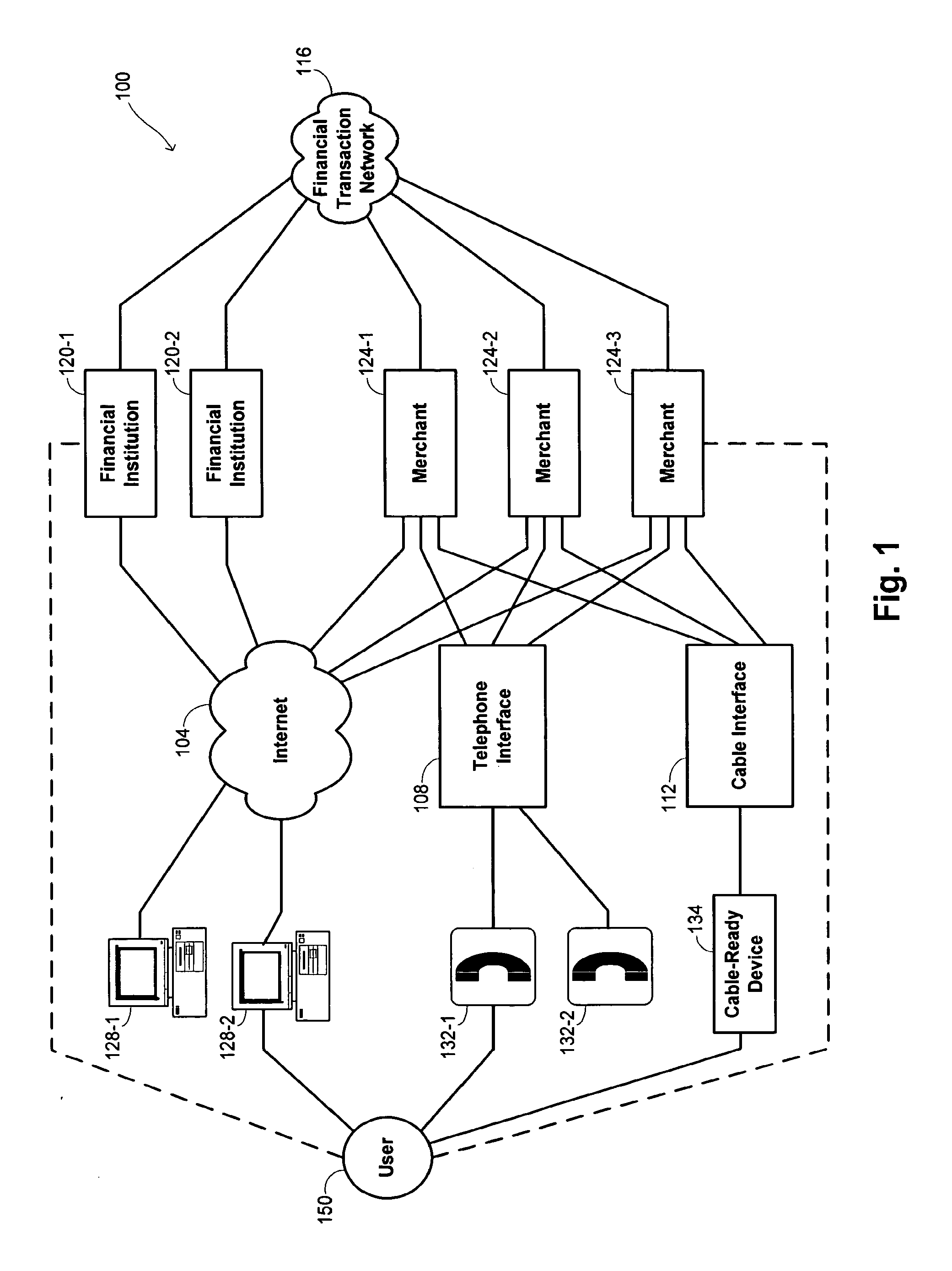

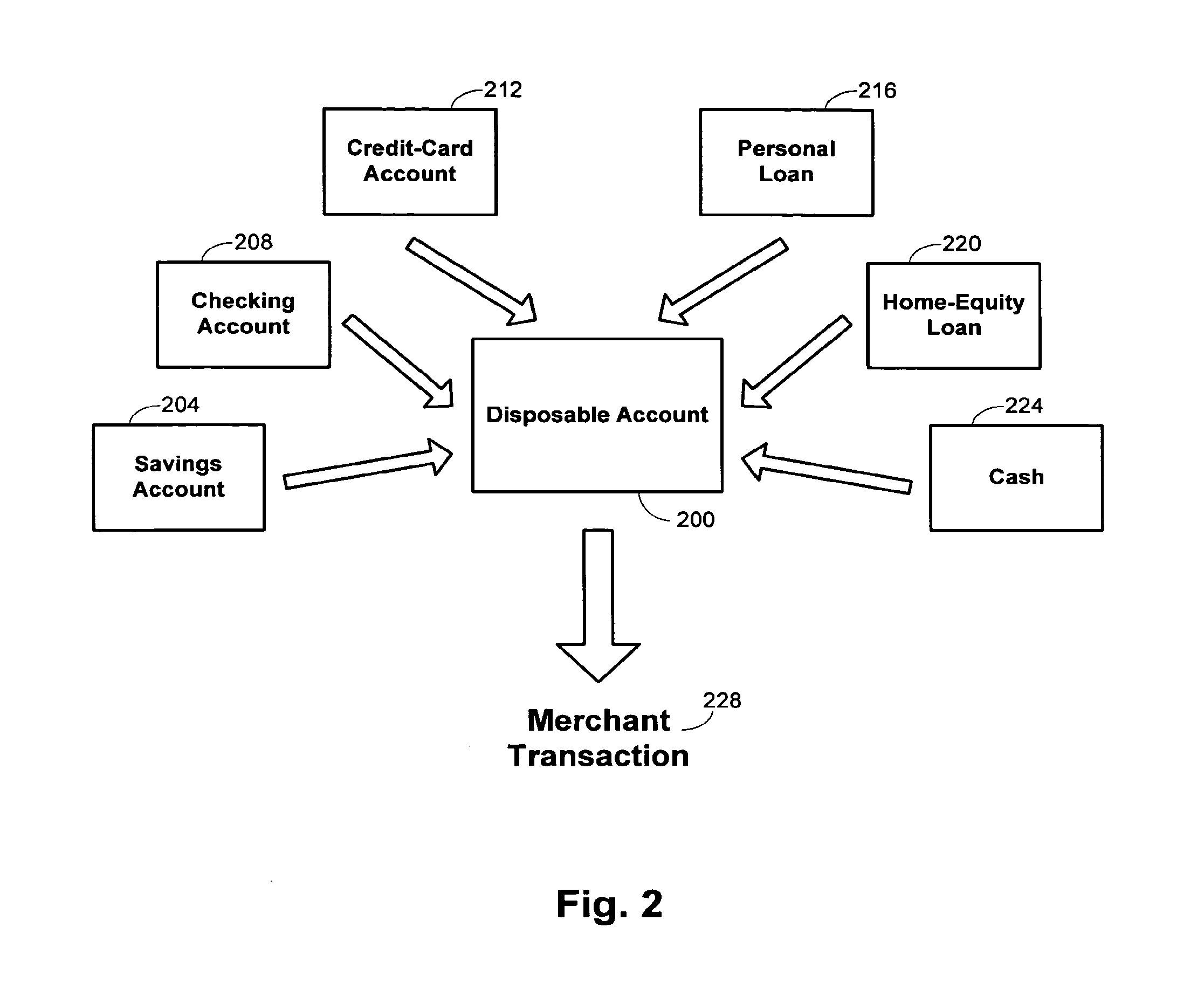

Disposable payment account

InactiveUS20070168279A1Improve securityLimiting financial exposureFinancePayment circuitsAuthorizationLump sum

Methods are provided of processing a transaction between a consumer and a merchant with a disposable financial account. The disposable financial account is created automatically at a financial institution upon receipt of information provided by the consumer requesting creation of the account through an interface with the financial institution. The consumer is provided with information identifying the disposable financial account through the interface. An authorization request for the transaction is received from the merchant over a financial processing network. The authorization request includes the information identifying the disposable financial account and a transaction amount. An approval for the authorization request is returned to the merchant over the financial processing network based on financial parameters of the disposable financial account. Funds are transferred from the disposable financial account corresponding to the transaction amount to control of the merchant. The disposable financial account is automatically closed after satisfaction of a predetermined condition.

Owner:FIDELITY INFORMATION SERVICES LLC

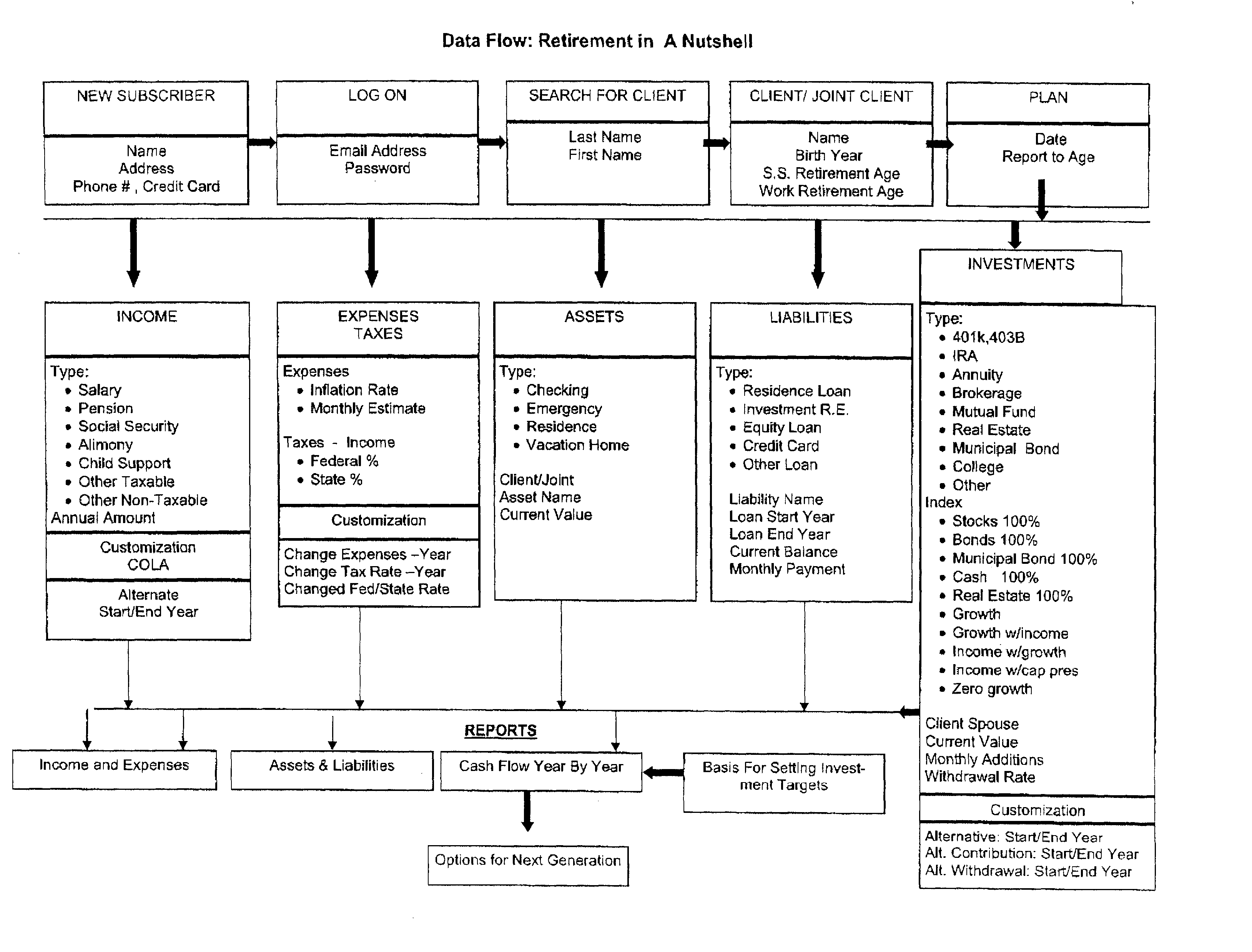

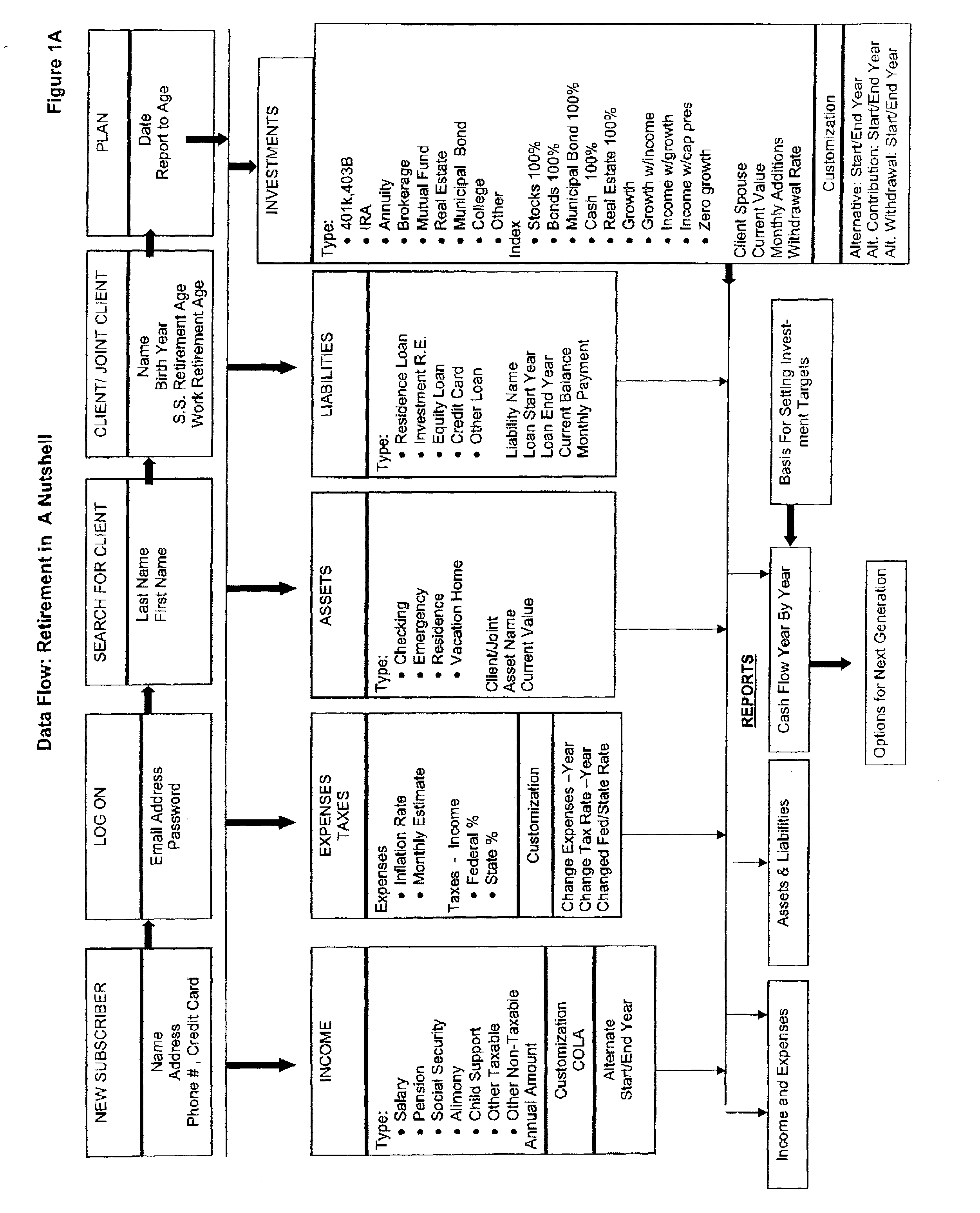

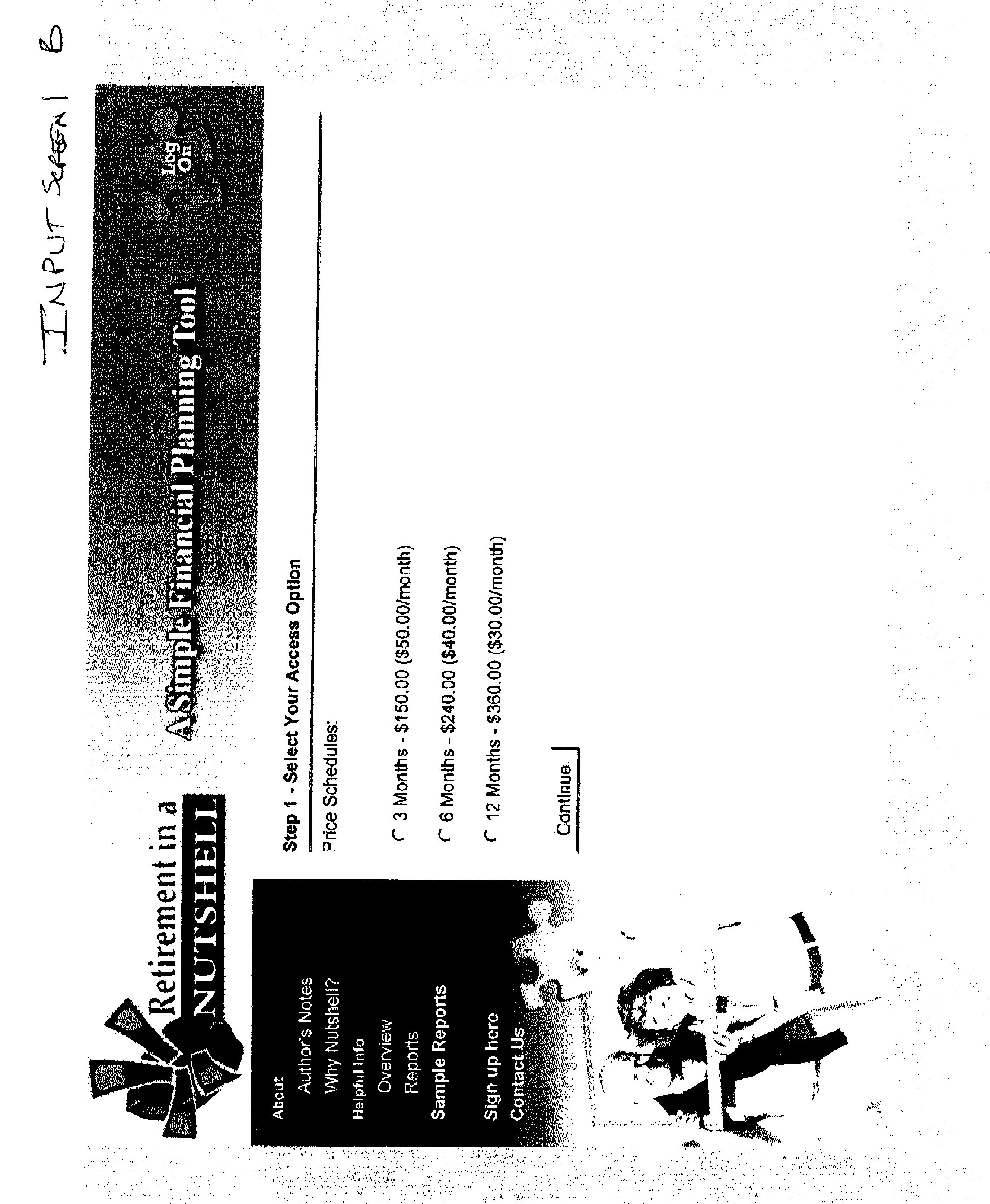

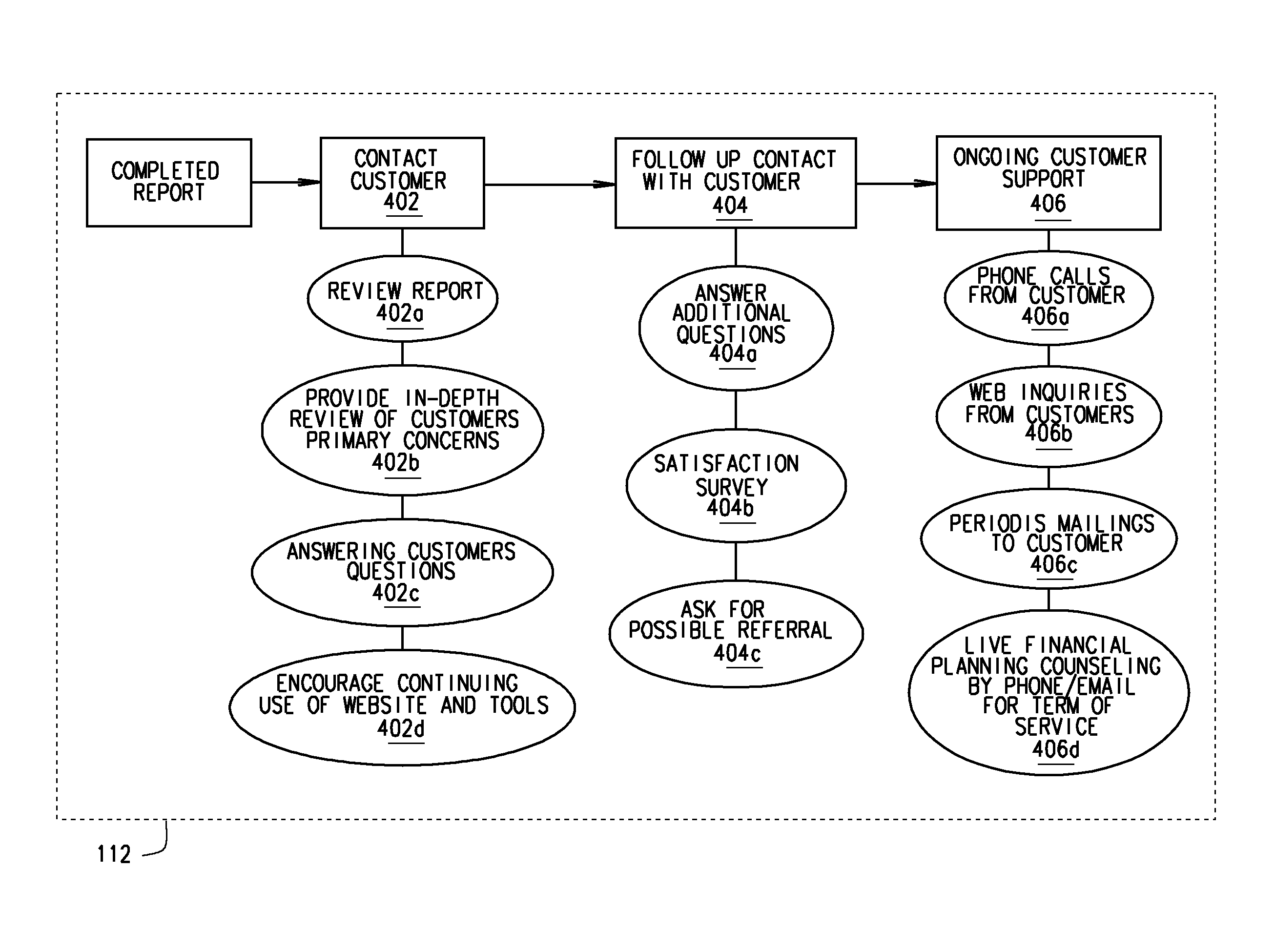

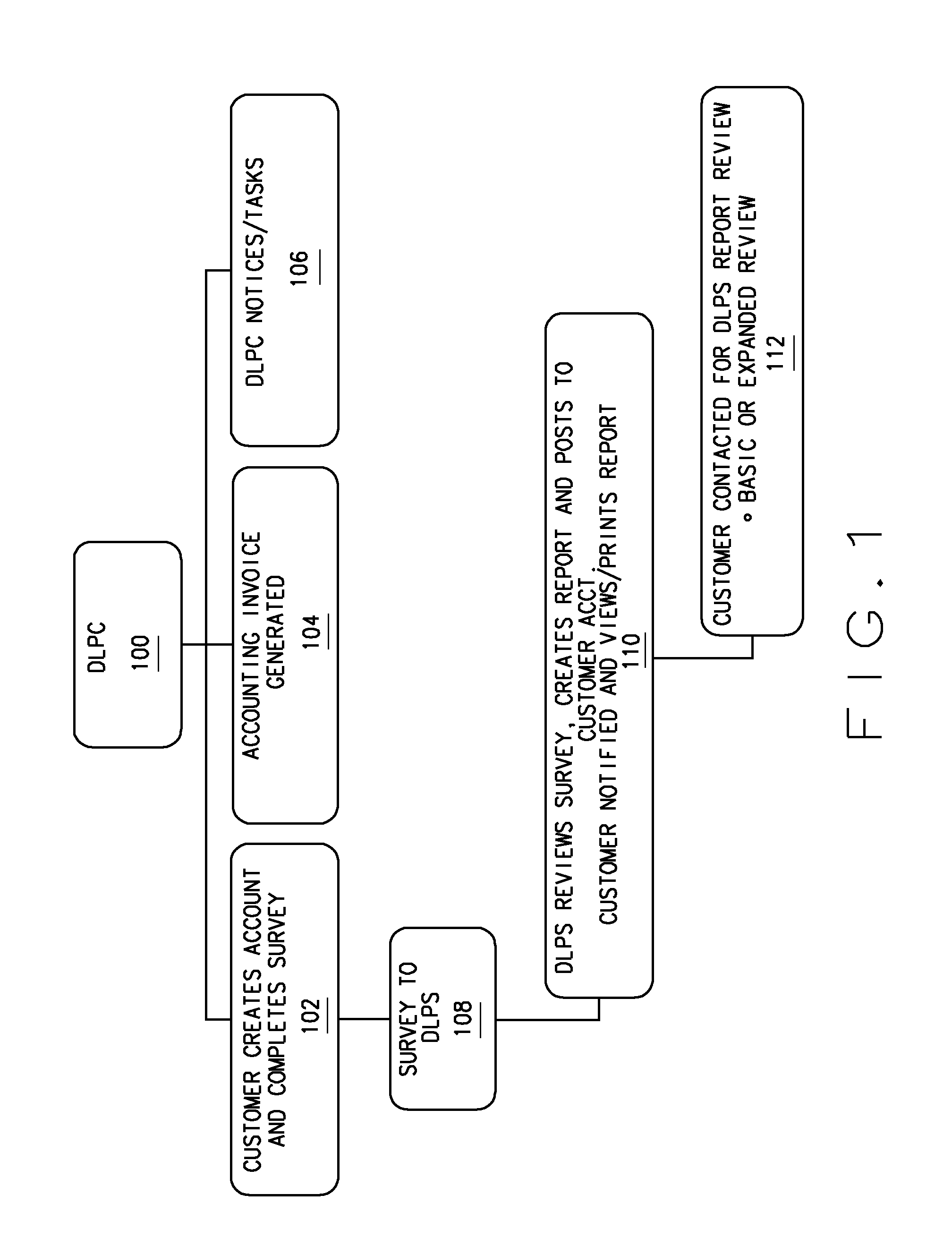

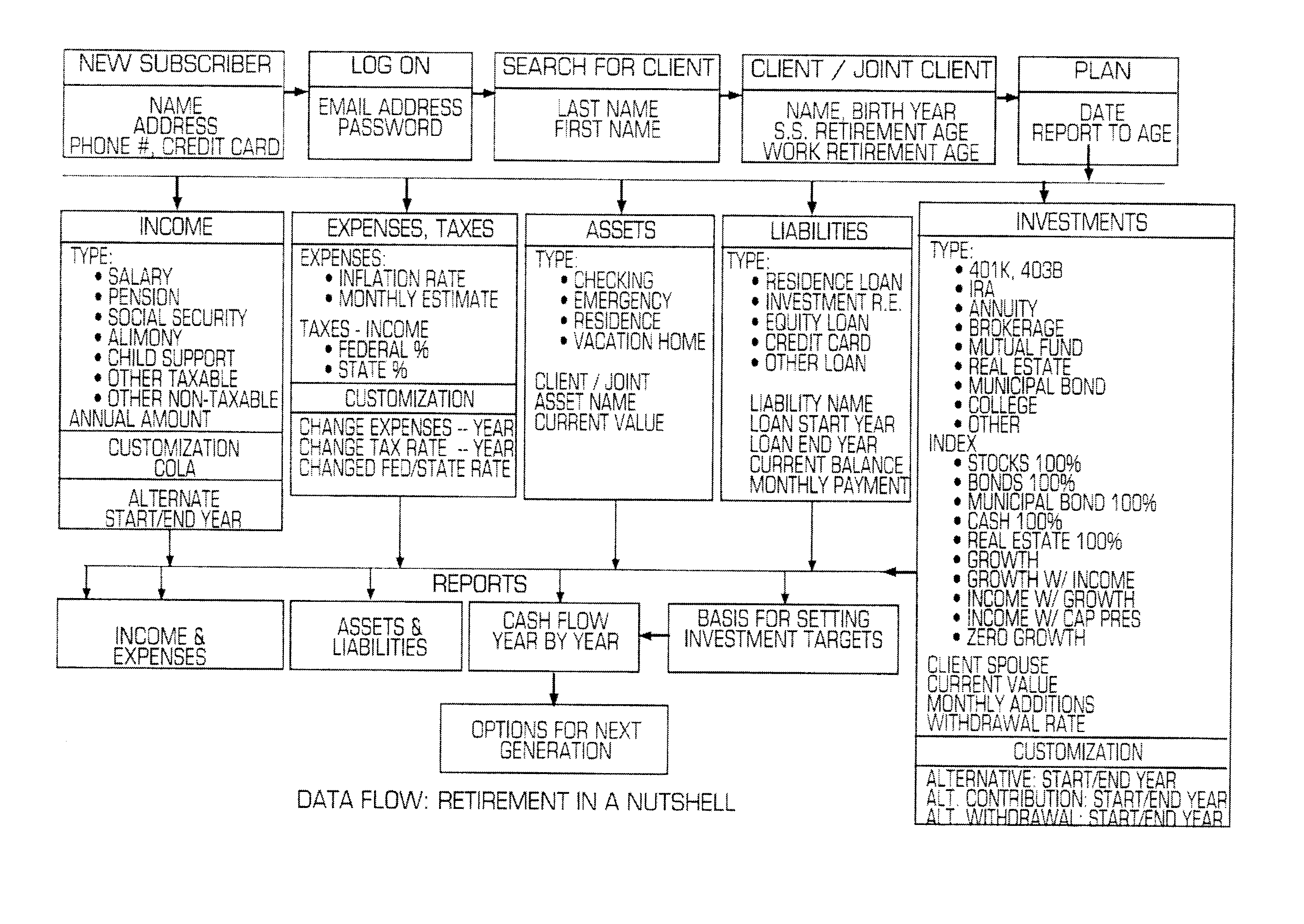

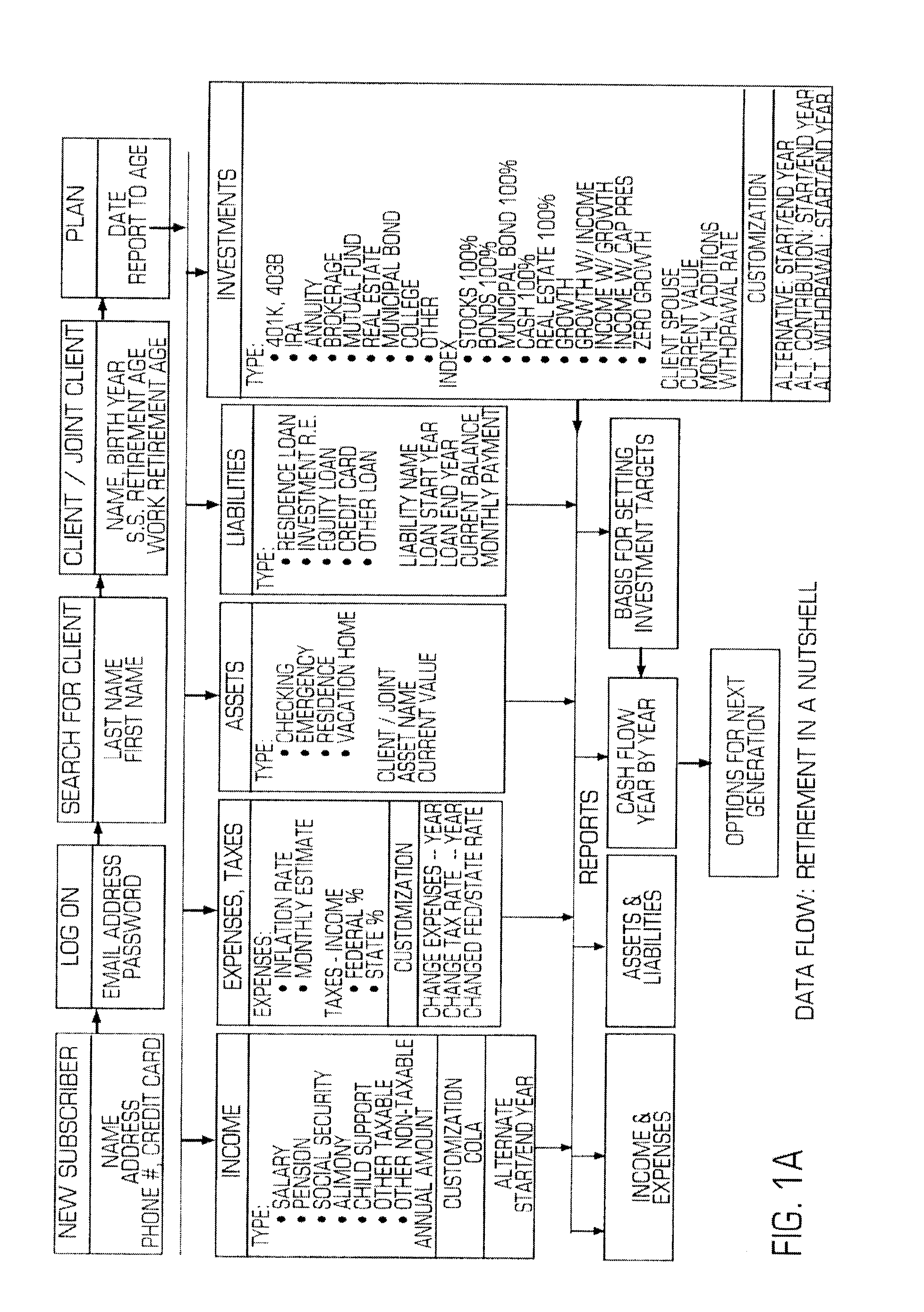

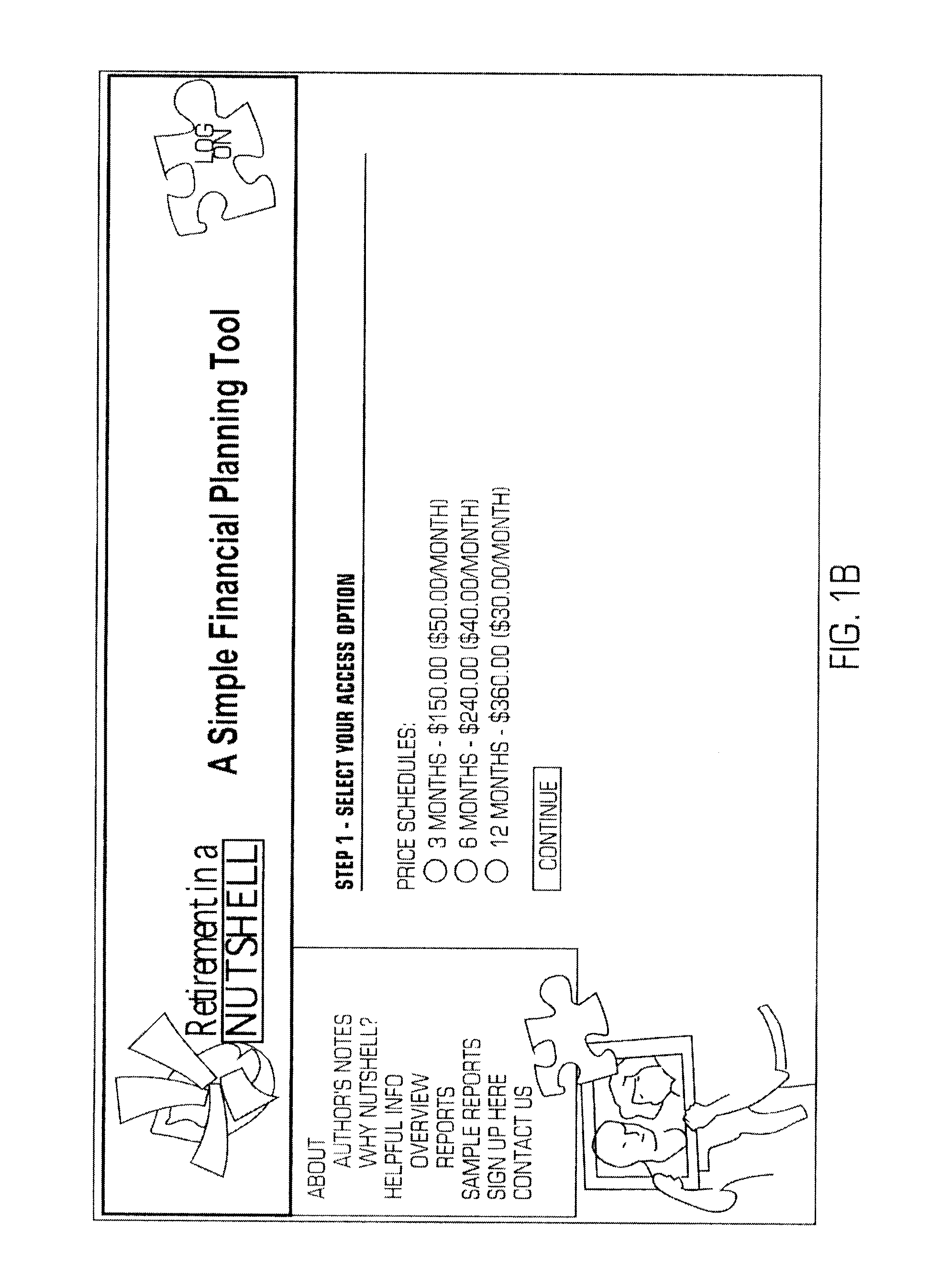

Financial Planning Document and Process Therefor

A computer program that can be installed on a web server to assemble web pages that can be accessed over the Internet by password to prepare financial planning reports for a client. The program takes gross income, subtracts income taxes, subtracts all money put into savings programs, and whatever is left is what the client spends in a given year or month. It further itemizes and subtracts the monthly payments for debt service since these items will be fully amortized or paid off at some point in the future and should not be included in baseline living expenses that will continue through a person's lifetime. The balance left after these calculations are completed represents the individual's current annual living expenses or standard of living that needs to be sustained throughout their lifetime with adjustments for inflation. The program can produce three major reports: (1) an income and expense report; (2) an asset and liability report or balance sheet; and (3) a cash flow report that shows all of items that impact cash flow on a year by year basis throughout the rest of the individual or client's lifetime. If there are cash flow shortfalls in any year, the program uses a two step present value calculation to determine how much the individual would need in a lump sum today or contribute monthly or annually to provide sufficient funds in the year needed to fill the shortfall.

Owner:YOUNG ROBERT A

System and method for processing and administering flexible guaranteed income payments

A system is provided for administering fixed income immediate and deferred payments in any of a plurality of different payout schemes selected by a purchaser to accommodate varying retirement income needs. The system can be configured to administer an immediate income annuity where payments start within one year and the system can also administer a deferred payout annuity through a single dual natured payout contract. Additional options available for administration by the system include options to permit the contract owner to change the annuity commencement date and the ability to commute future period certain periodic payments into a single lump sum payment.

Owner:TALCOTT RESOLUTION LIFE INSURANCE CO

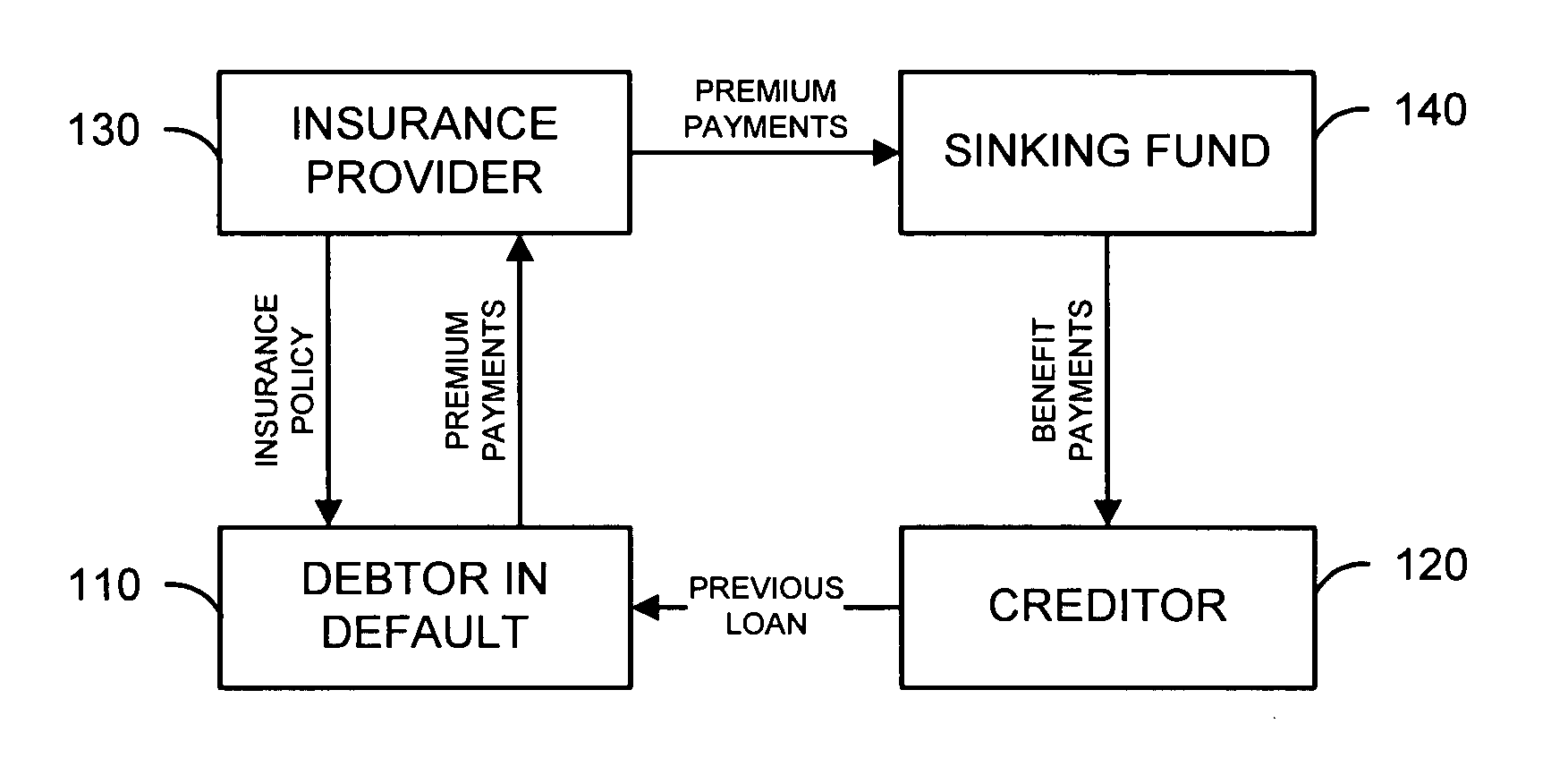

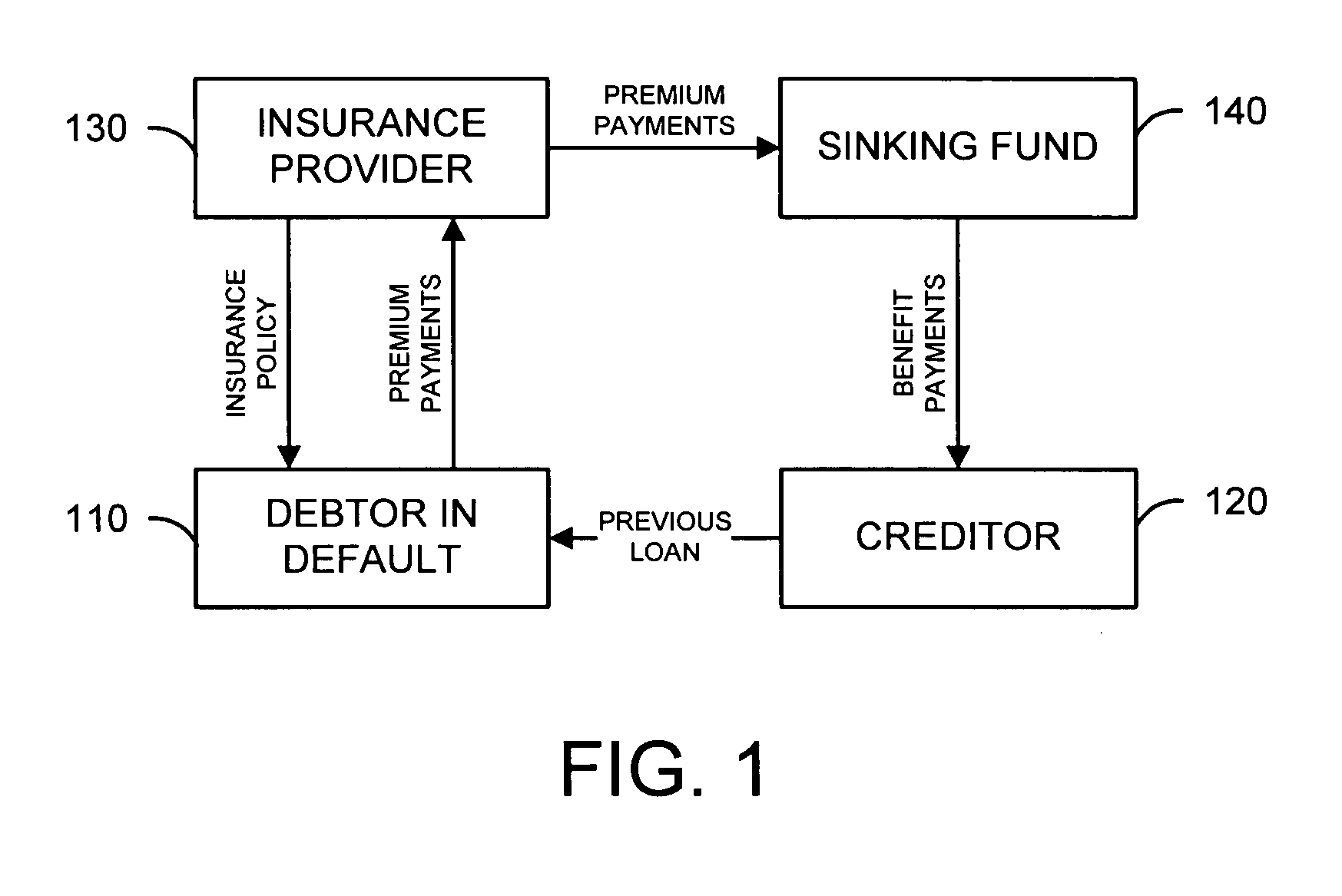

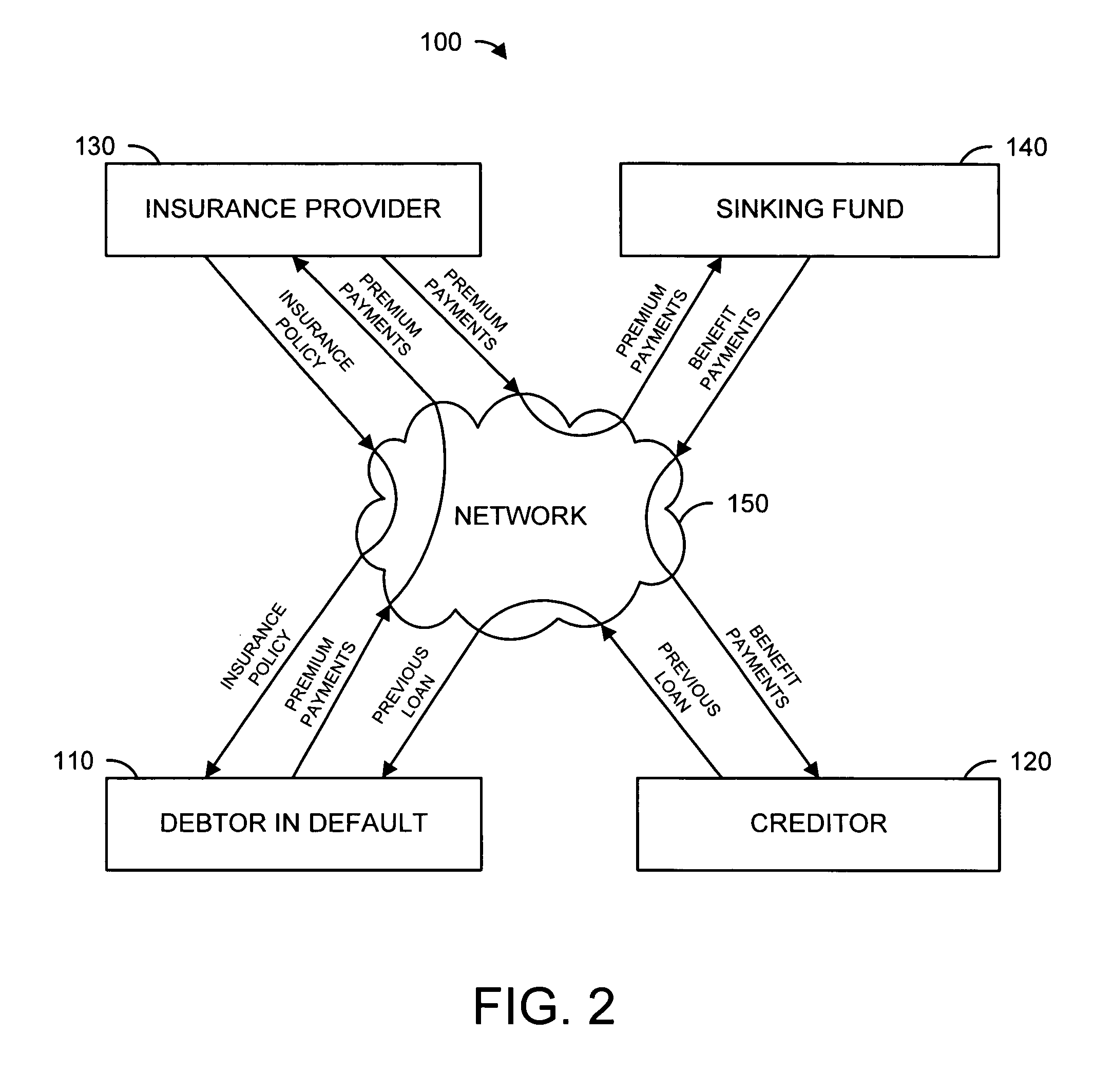

Debt collection system

Improved methods, systems, and software are provided for facilitating debt collection by utilizing a non-term life insurance policy for making payments due by debtors to creditors. The life insurance policy can be implemented as, or in conjunction with, a sinking fund for maintaining premium payments received from a debtor under the policy. Periodic and / or lump sum payments to the creditor on behalf of the debtor can be made from the sinking fund, allowing the creditor to receive satisfaction of the debt. Various features can be implemented to provide for the entire amount of debt owed by the debtor to the creditor and further provide cash flow to the creditor after an initial period of contribution. In the event of death of the debtor, the creditor can receive full payment for the outstanding debt.

Owner:SILVERMAN GARY C

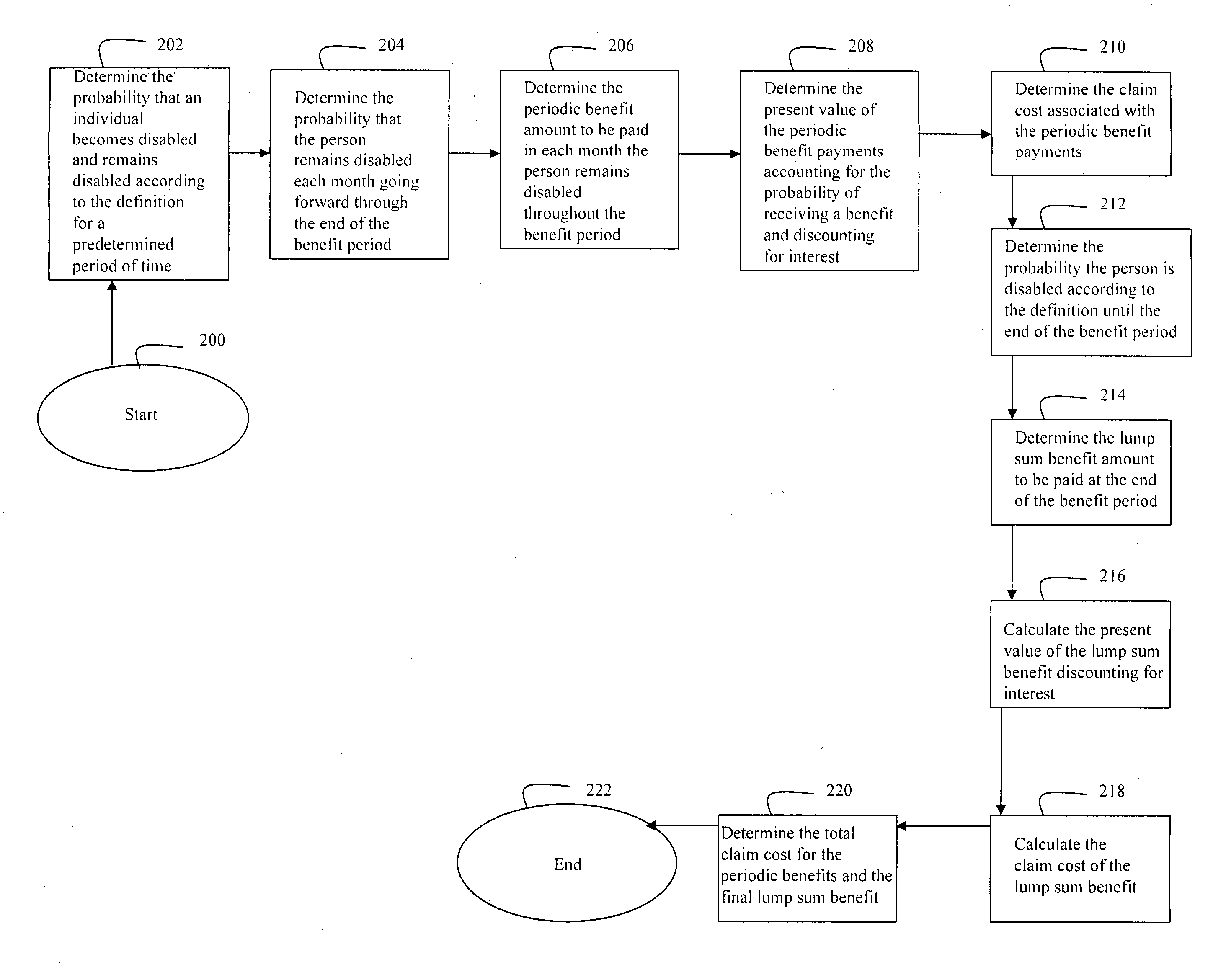

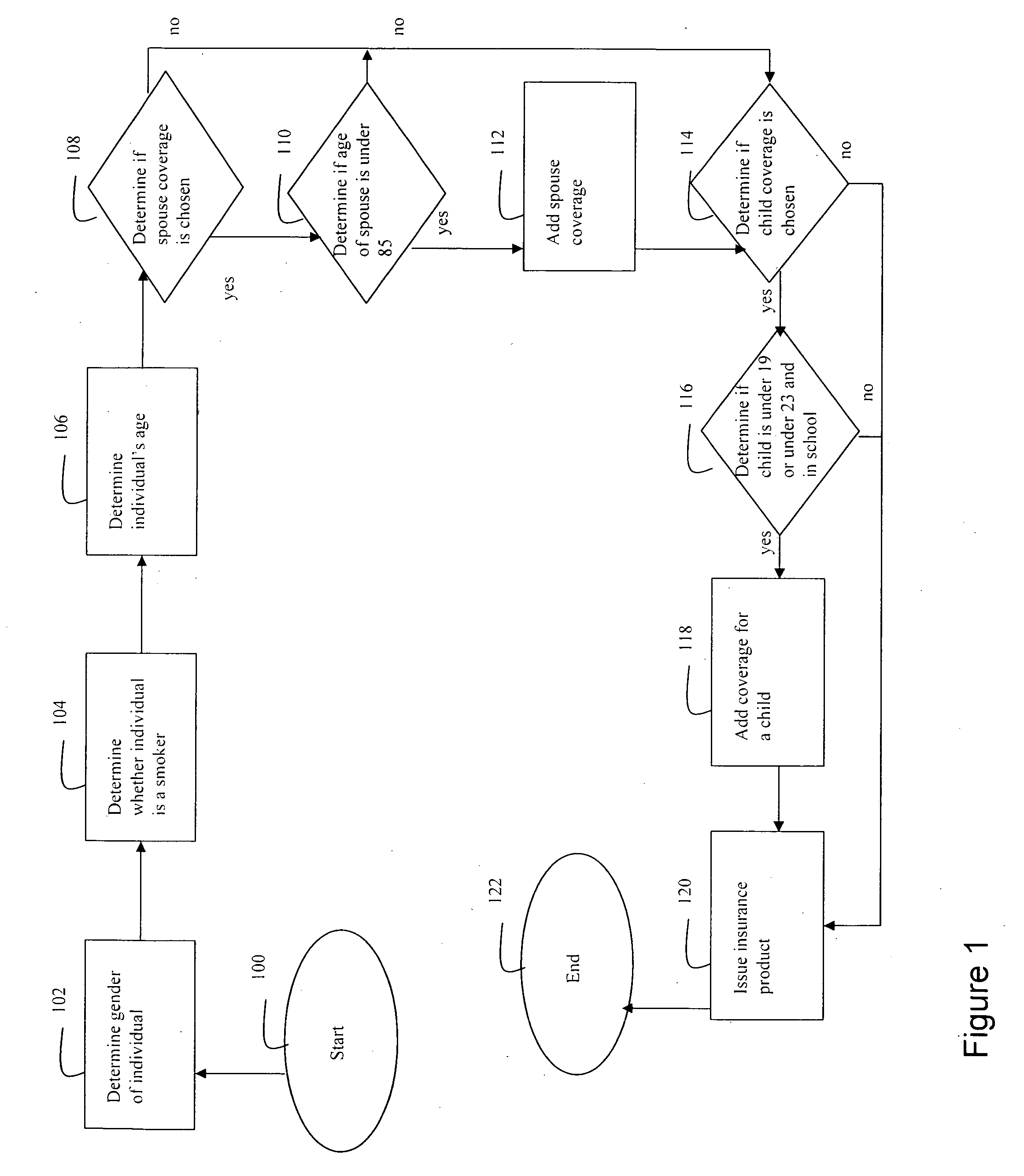

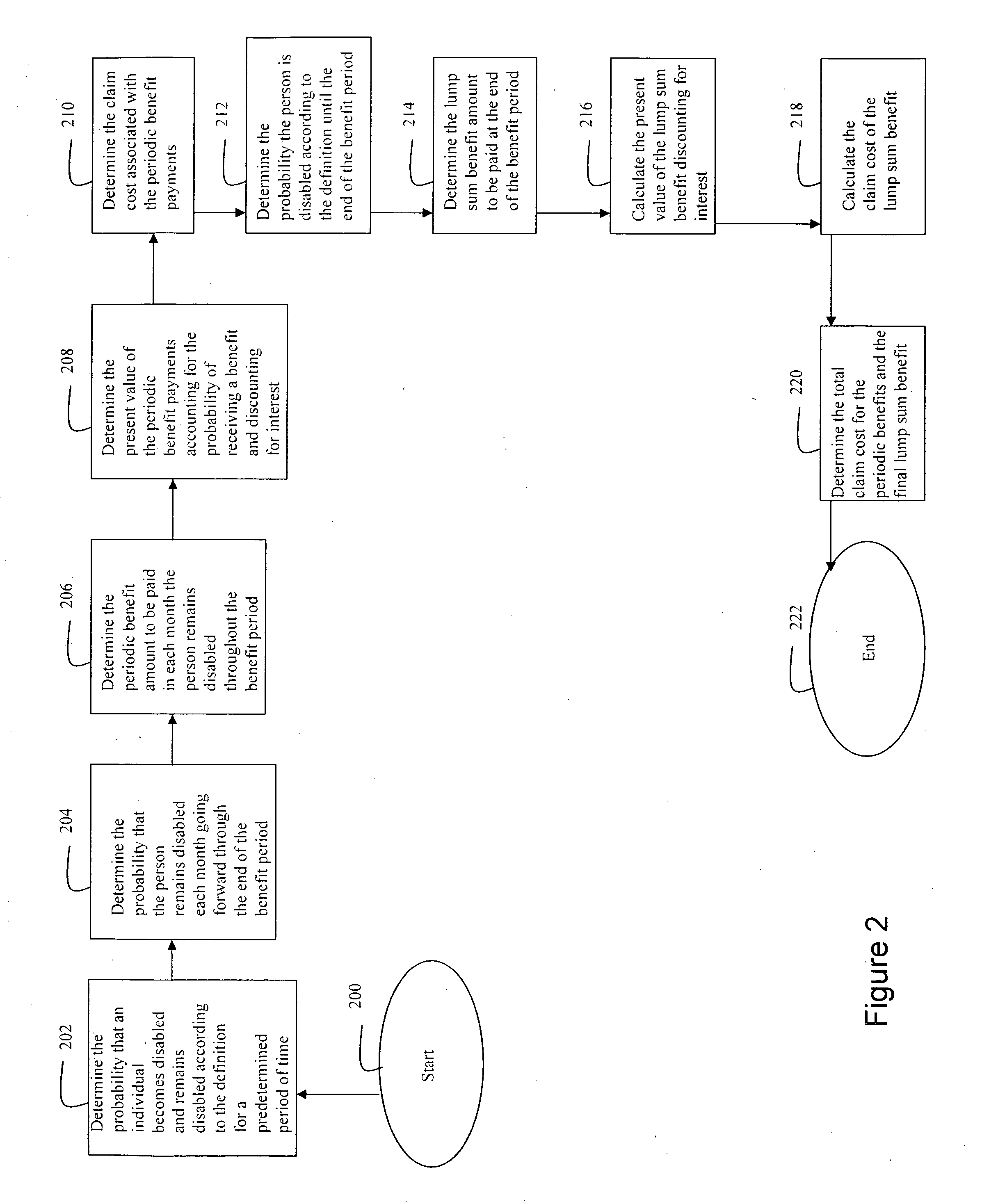

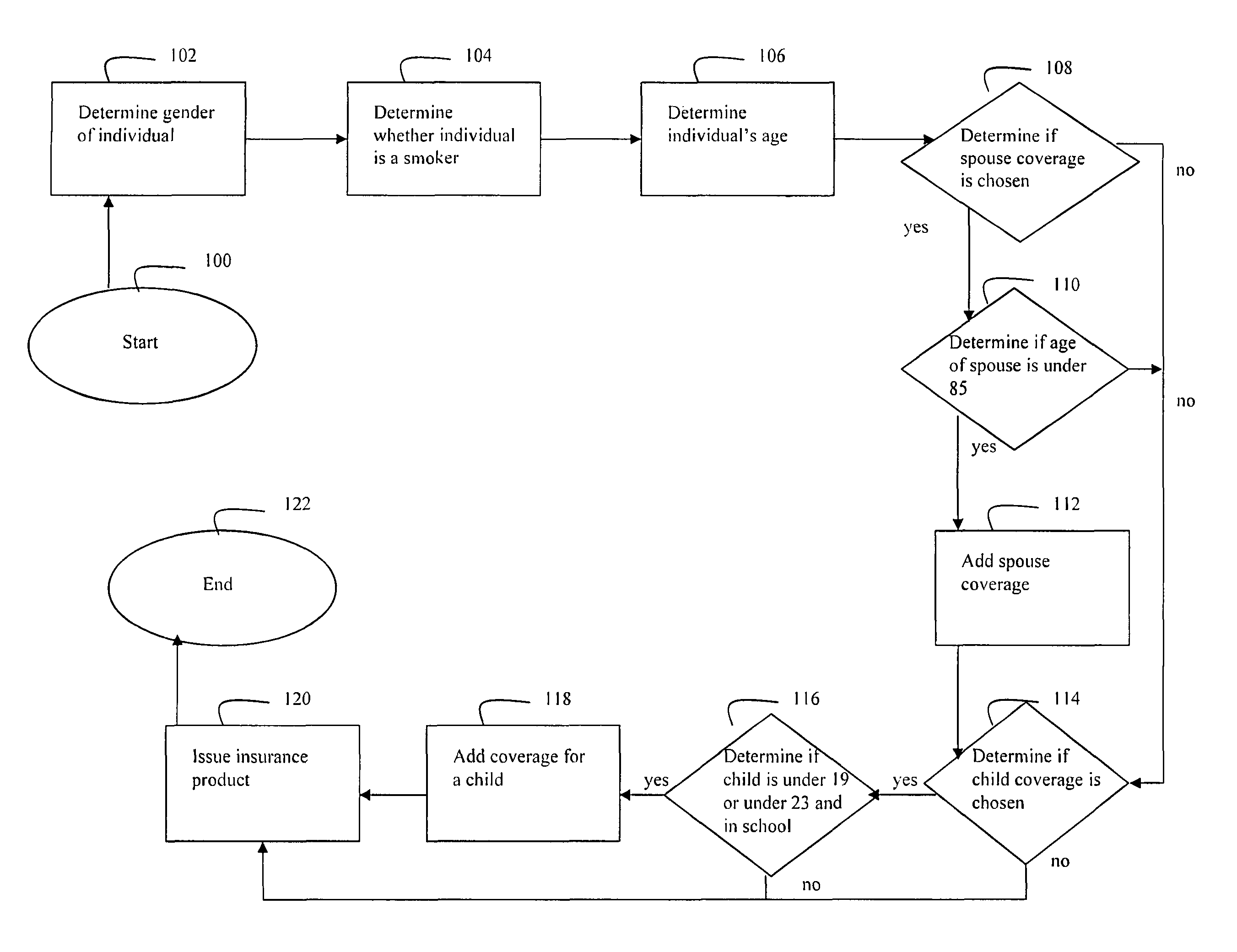

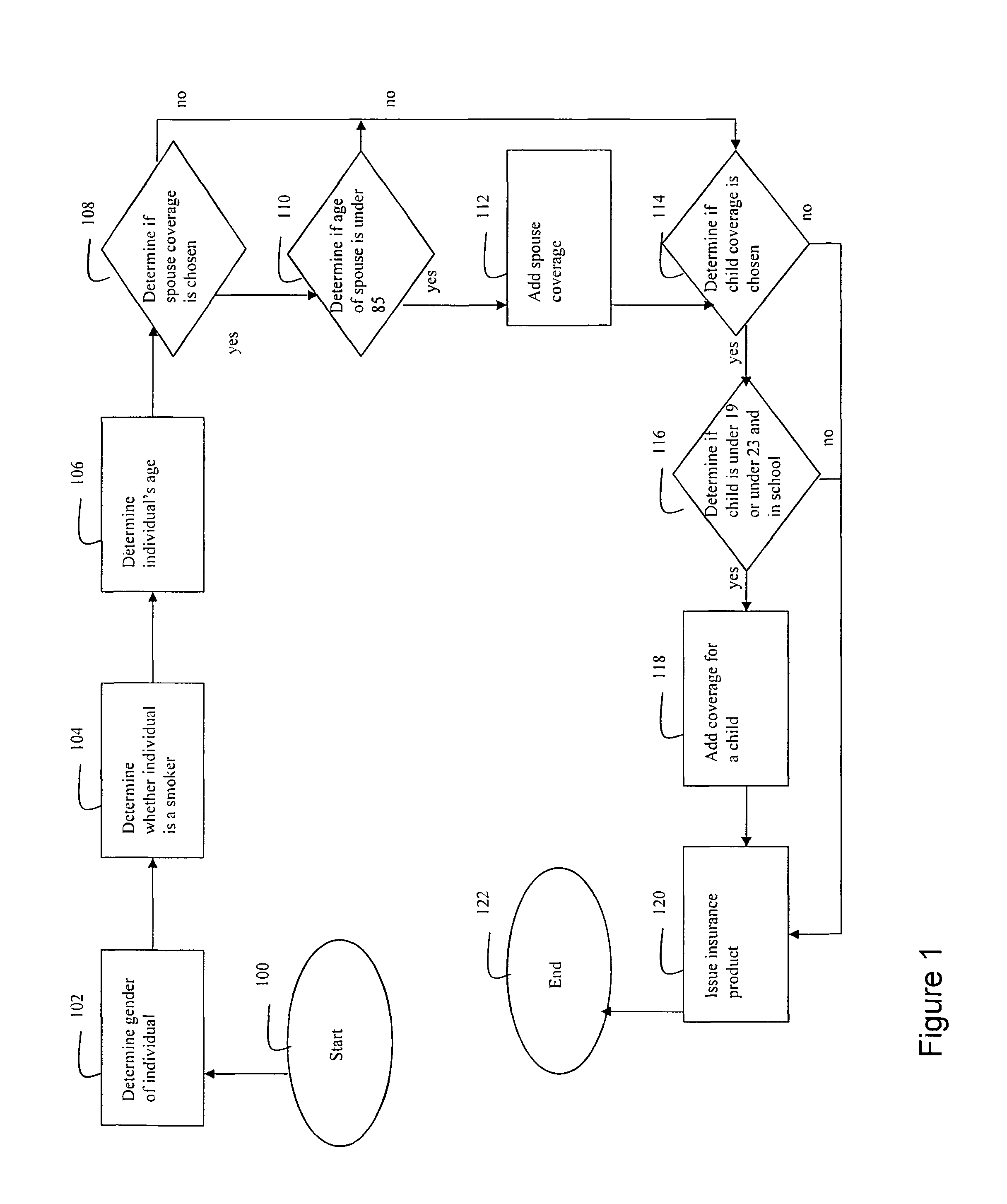

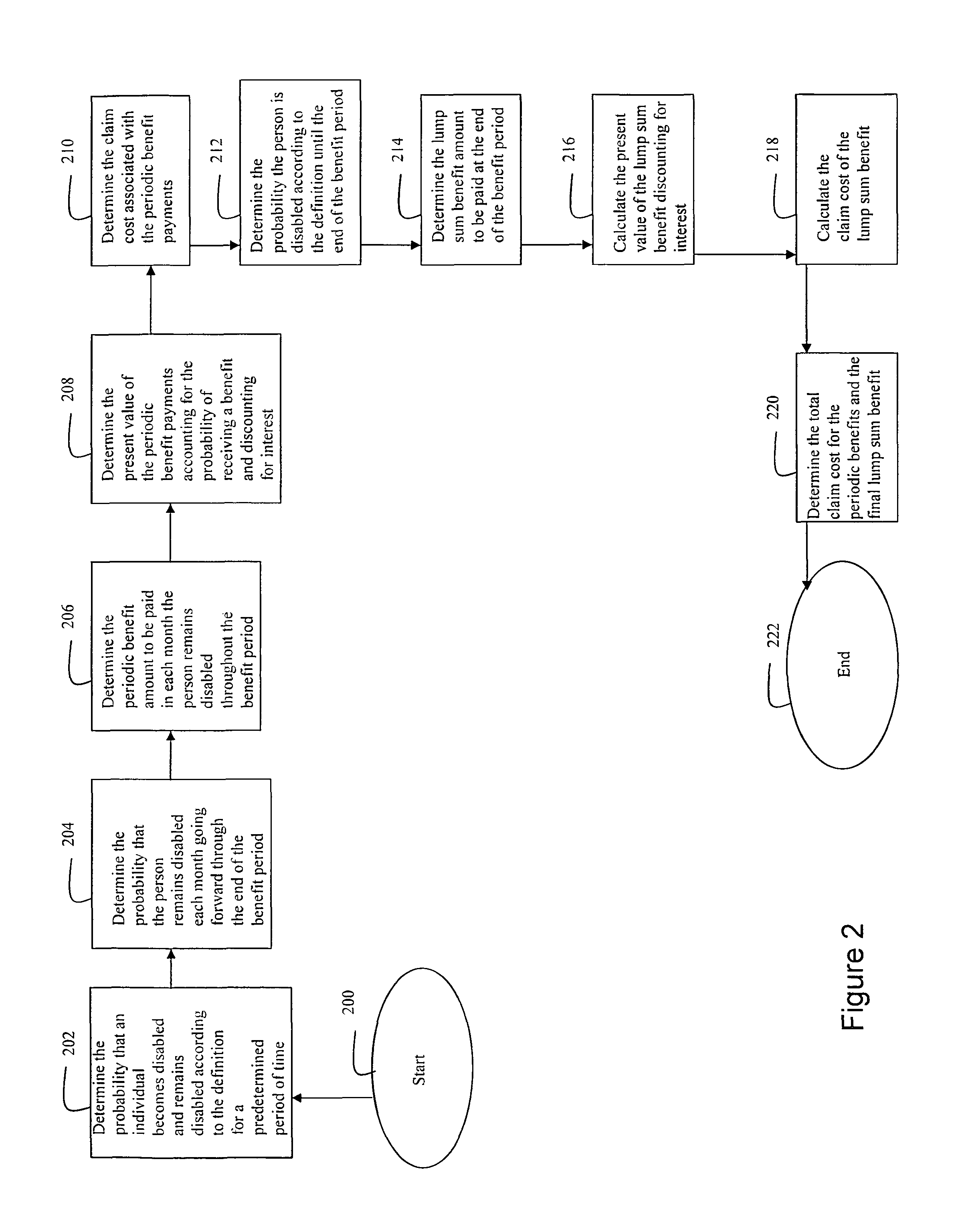

System and method for generating and providing a simplified voluntary disability product

Disclosed is a novel disability insurance product that provides a benefit to the purchaser. The insurance product comprises a disability insurance product which offers coverage for a predetermined limited period of time. If at the end of the predetermined period of time the insured individual is still disabled according to the terms of the insurance product, the insurance provider will pay a lump sum benefit.

Owner:HARTFORD FIRE INSURANCE

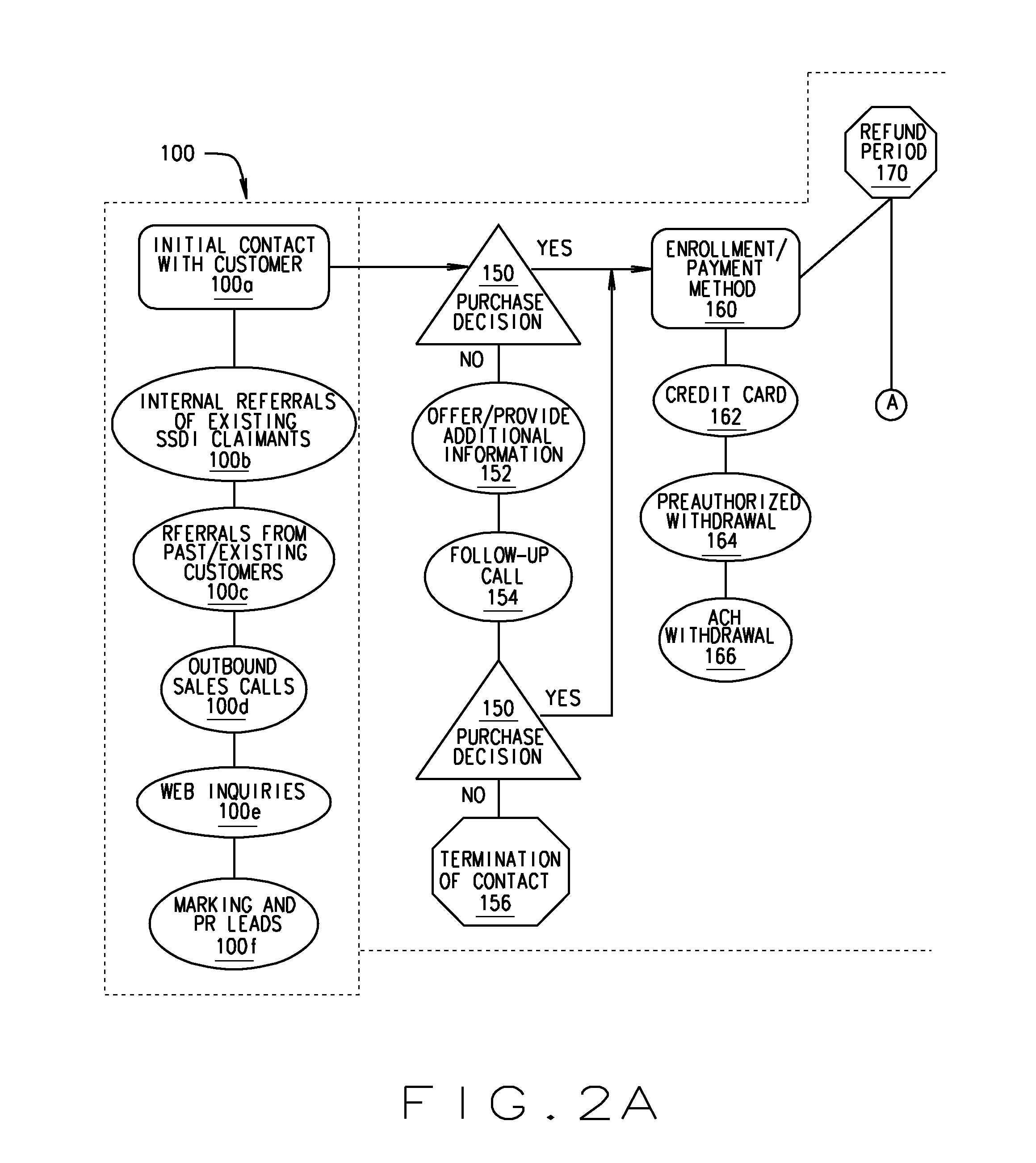

Life Planning Services For Disabled Individuals

A comprehensive system for providing quality of life enhancing services to disabled individuals or qualifying participants comprising a plurality of services including life planning services, financial services, tax services, lump sum payment management services, Medicare Advisor Service, Social Security Disability Insurance representation, healthcare discount card and stored value card services.

Owner:ALLSUP INC

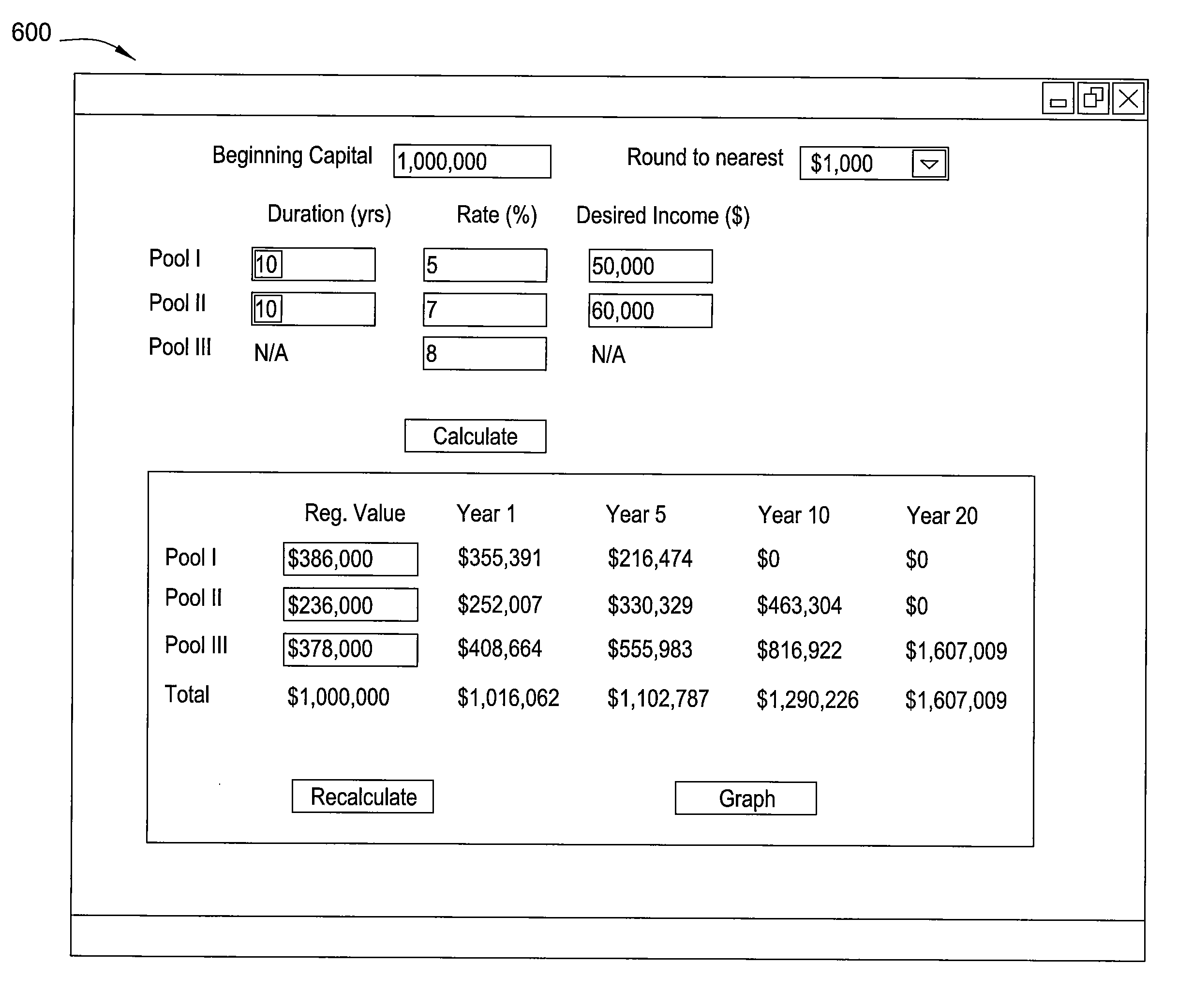

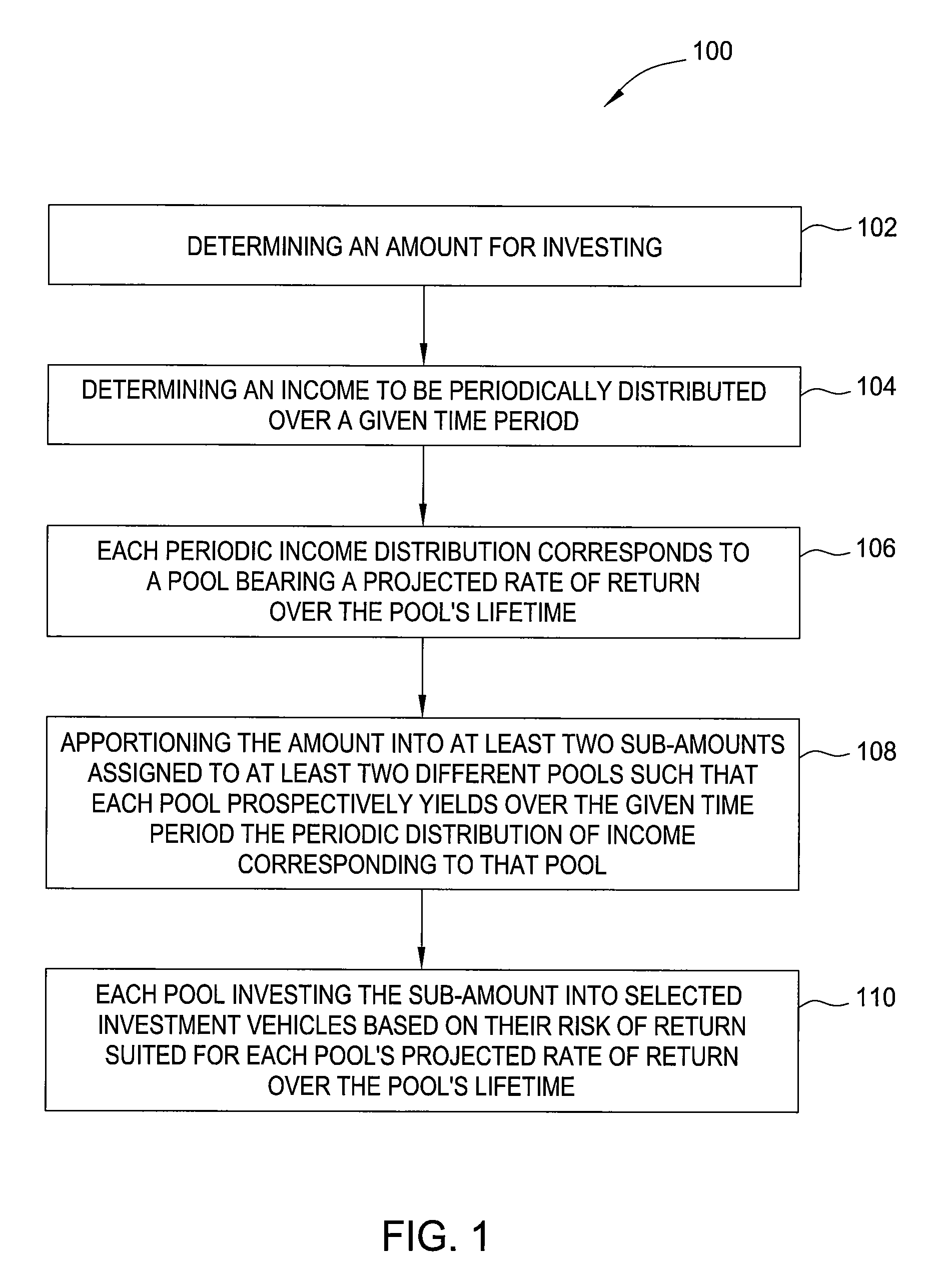

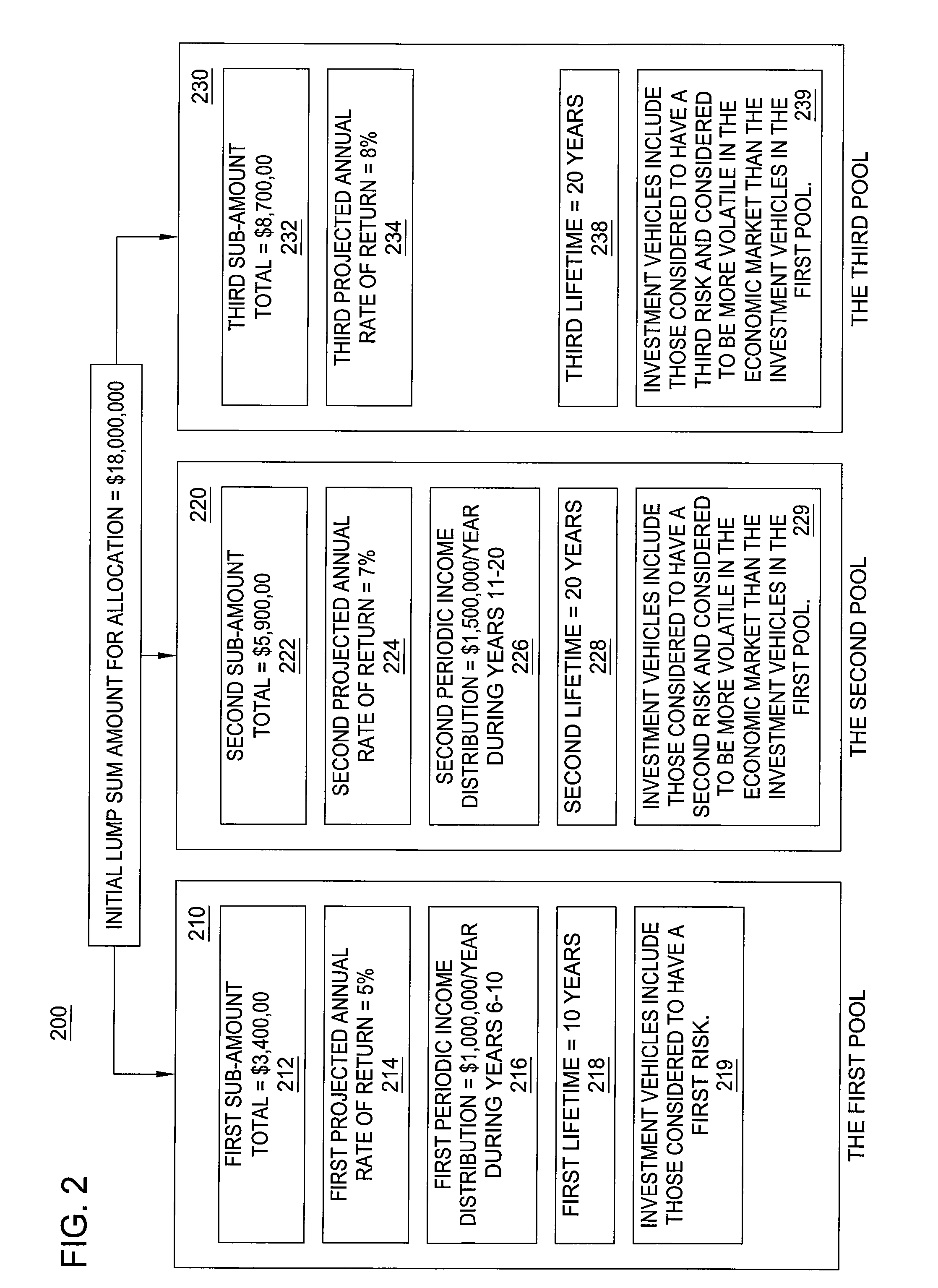

Investment portfolio allocation

A method and a system of allocating a lump sum of money for to continue asset growth while at the same time providing income with some asset preservation are disclosed. The method includes determining an amount for investing and an income to be periodically distributed over a given time period. Each periodic income distribution corresponds to a pool having a lifetime and bearing a projected rate of return over the pool's lifetime. The method also includes apportioning the amount into at least two sub-amounts assigned to at least two different pools such that each pool prospectively yields over the given time period the periodic distribution of income corresponding to that pool. Each pool invests the sub-amount into selected investment vehicles based on their risk of return suited for each pool's projected rate of return over the pool's lifetime.

Owner:RUGGIE THOMAS H

Conditional fee ownership home financing system and business method

InactiveUS20030236733A1Increases potential lending marketFinanceSpecial data processing applicationsLump sumComputer science

A method and system for financing the purchase of real property utilizing a conditional fee simple deed. Under this method a conditional fee purchaser and a conditional remainder purchaser enter into a conditional fee agreement, delineating the rights and responsibilities of each party with regards to the purchase of a residential property. The agreement includes a determination date, at which time, the conditional remainder purchaser will either receive the entire fee simple interest in the property or will receive a lump sum payment from the conditional fee purchaser for the conditional remainder purchaser's interest in the real property. The conditional fee agreement includes a list of conditions under which the property will pass directly to the conditional remainder purchaser prior to the determination date.

Owner:WEEKS STEPHEN M

Conditional fee ownership home financing system and business method

A method and system for financing the purchase of real property or refinancing real property utilizing a conditional fee simple deed. Under this method a conditional fee purchaser and a conditional remainder purchaser enter into a conditional fee agreement, delineating the rights and responsibilities of each party with regards to the purchase or refinance of a residential property. The agreement includes a determination date, at which time, the conditional remainder purchaser will either receive the entire fee simple interest in the property or will receive a lump sum payment from the conditional fee purchaser for the conditional remainder purchaser's interest in the real property. The conditional fee agreement includes a list of conditions under which the property will pass directly to the conditional remainder purchaser prior to the determination date.

Owner:WEEKS STEPHEN M

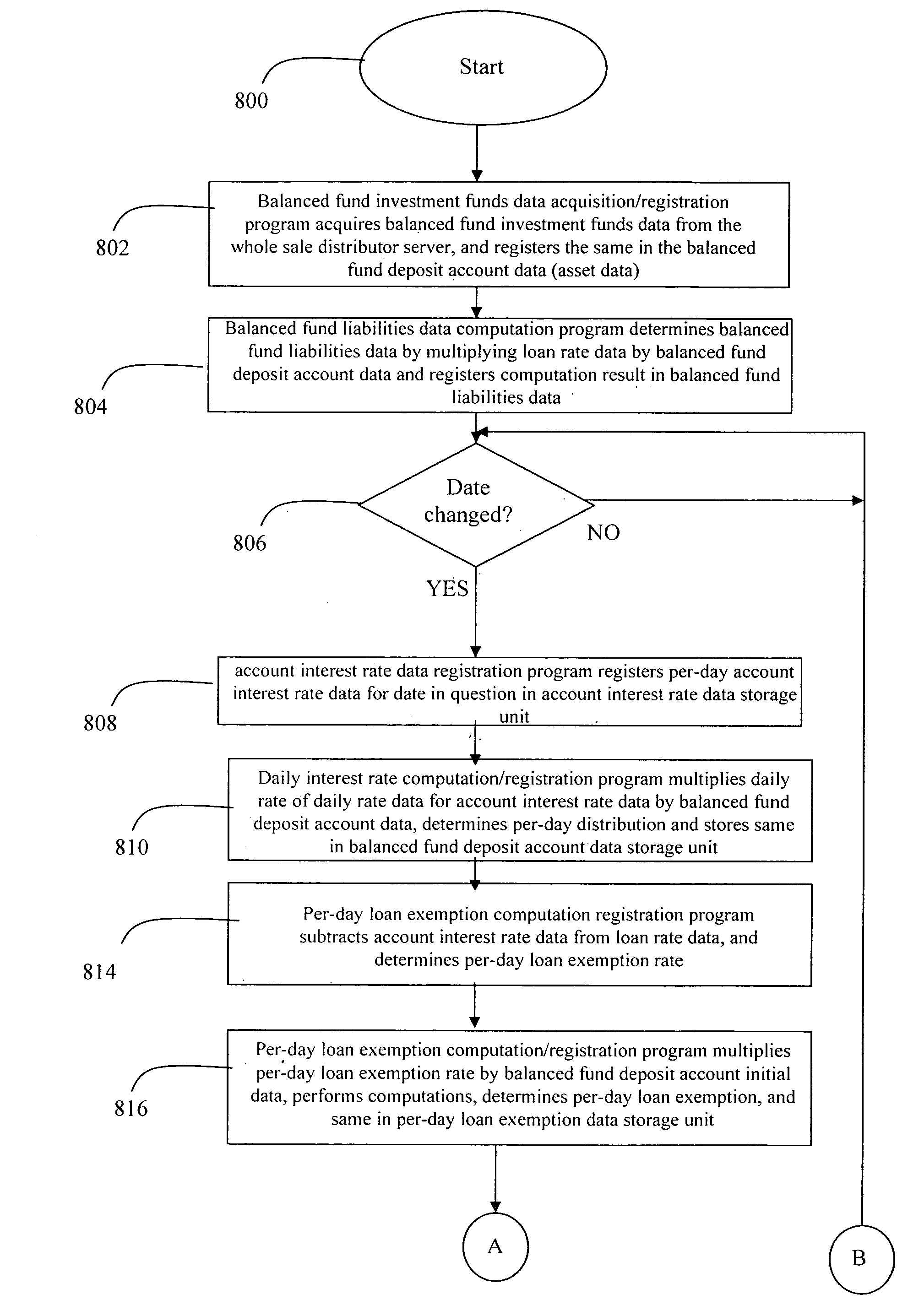

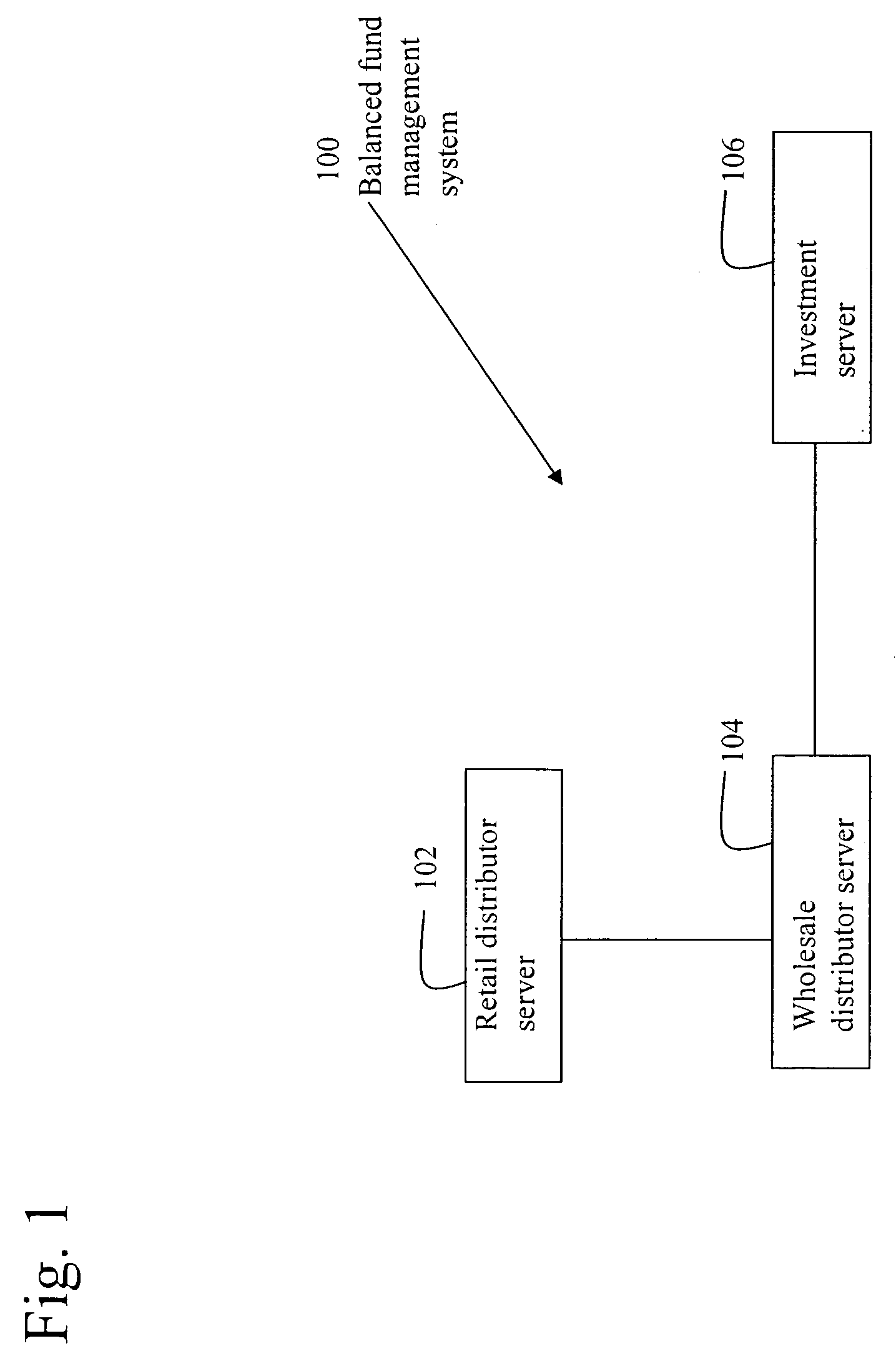

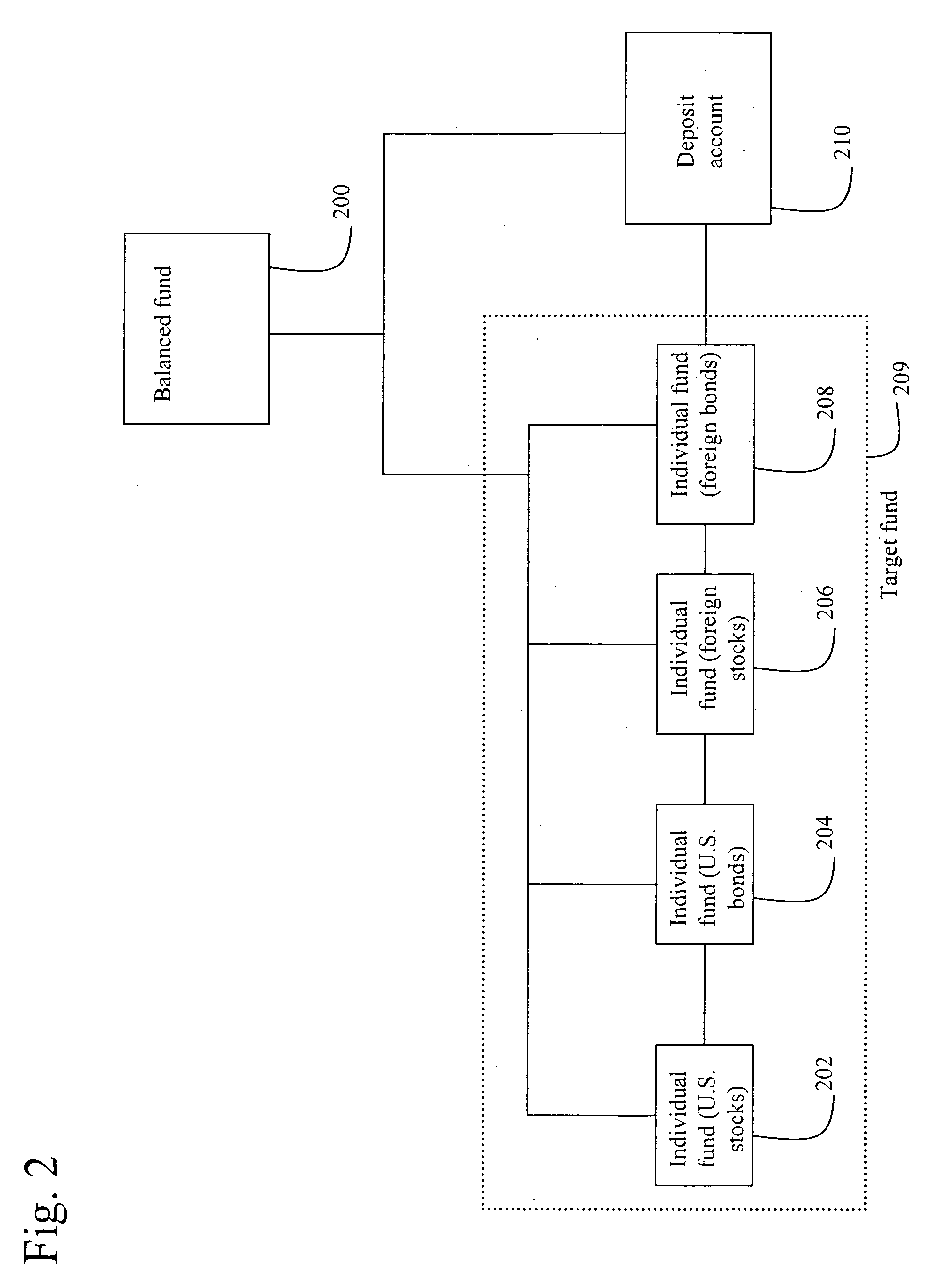

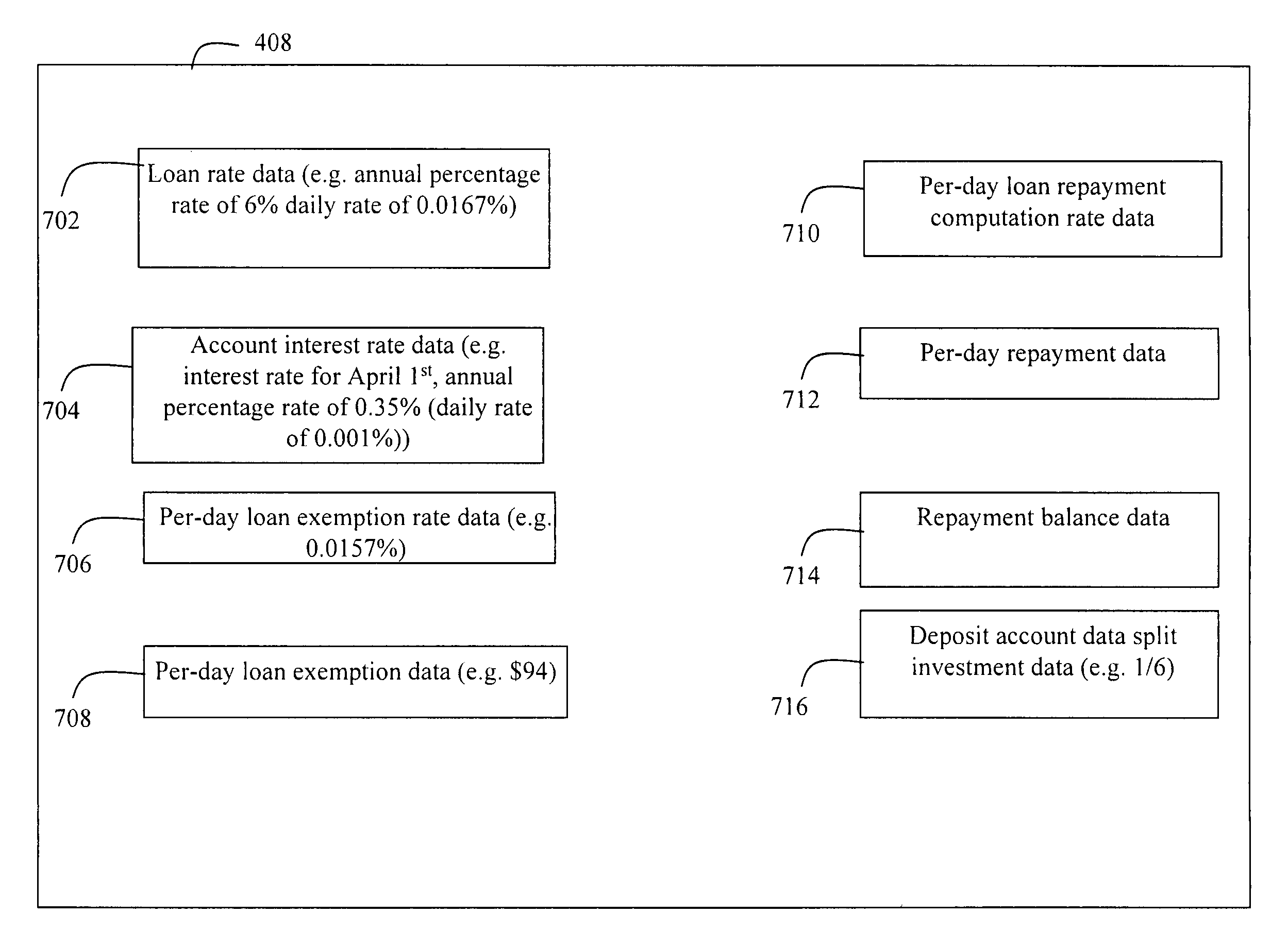

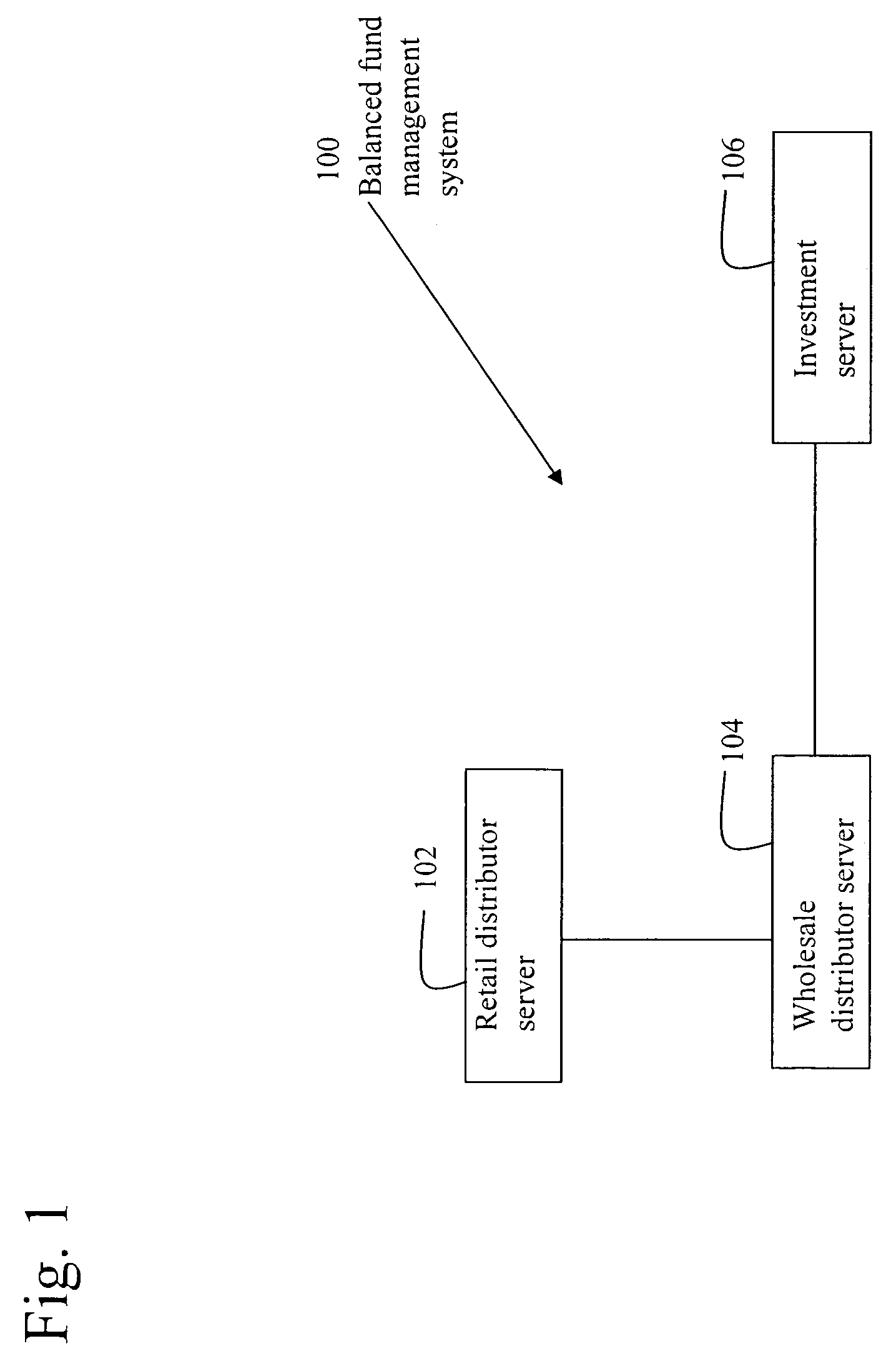

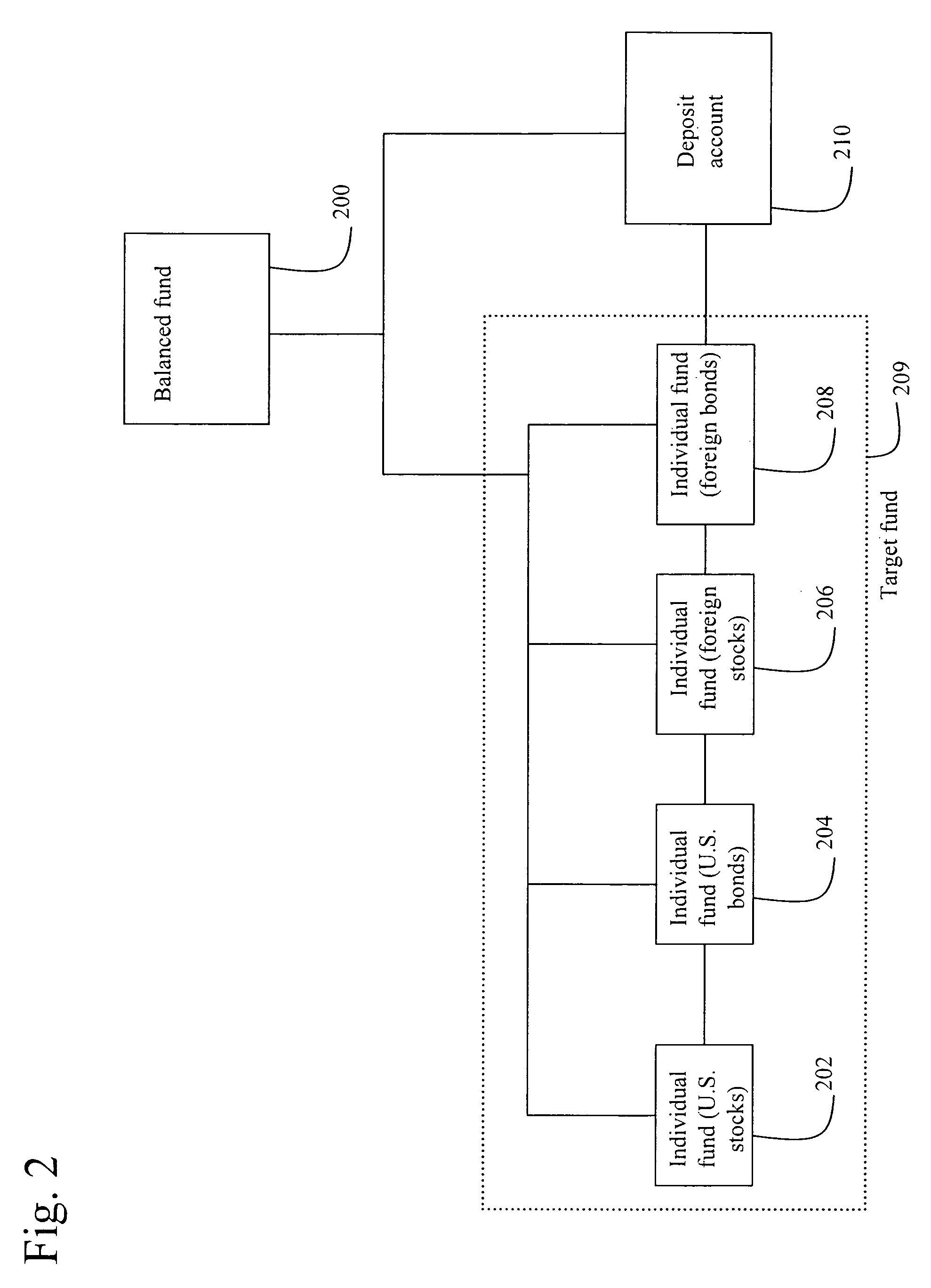

System and method for financial product management

The present invention provides a financial product management system for managing a financial product, which makes it possible to attempt to reduce the investment risk associated with current price fluctuations even when making a lump-sum investment without requiring the investor or distributor to divide the total funds into smaller amounts.

Owner:HARTFORD FIRE INSURANCE

A membership card of card-to-card foundation transferring and management and settlement system

InactiveCN101216928AMeet psychological needsCharity Credit GuaranteeComplete banking machinesFinanceBank accountEmblements

A membership card for transferring a donation of money from card to card and a management settlement system are provided. The system uses the customer's debit card of the nominated bank via swinging the principal card in the consumption of the authorized consumptive places, such as, shopping, dining and drinking, entertainment, lodging etc, transfers the balance generating from the consolidation of the oddment less than 100 yuan according to the signed voluntary agreement, and implements the card-to-card donation of the installment savings and the quota donation. The lump-sum withdrawal of the money subtracted from the donation according to the stipulation quota should use the supplementary card after one year and the annual interest rate sanctified by People's Bank of China is obtained. With the KK symbol and effectively extending the resource of bank accounts, the system has the functions of recognizing and transferring the account payable, the due deposit and the due donation, and printing the three data according to the demands. The system is applicable to the member expansion of the banks and the emporiums and the marketing activities.

Owner:谭伏根

System and method for generating and providing a simplified voluntary disability product

Disclosed is a novel disability insurance product that provides a benefit to the purchaser. The insurance product comprises a disability insurance product which offers coverage for a predetermined limited period of time. If at the end of the predetermined period of time the insured individual is still disabled according to the terms of the insurance product, the insurance provider will pay a lump sum benefit.

Owner:HARTFORD FIRE INSURANCE

Financial planning document and process therefor

A computer program that can be installed on a web server to assemble web pages that can be accessed over the Internet by password to prepare financial planning reports for a client. The program takes gross income, subtracts income taxes, subtracts all money put into savings programs, and whatever is left is what the client spends in a given year or month. It further itemizes and subtracts the monthly payments for debt service since these items will be fully amortized or paid off at some point in the future and should not be included in baseline living expenses that will continue through a person's lifetime. The balance left after these calculations are completed represents the individual's current annual living expenses or standard of living that needs to be sustained throughout their lifetime with adjustments for inflation. The program can produce three major reports: (1) an income and expense report; (2) an asset and liability report or balance sheet; and (3) a cash flow report that shows all of items that impact cash flow on a year by year basis throughout the rest of the individual or client's lifetime. If there are cash flow shortfalls in any year, the program uses a two step present value calculation to determine how much the individual would need in a lump sum today or contribute monthly or annually to provide sufficient funds in the year needed to fill the shortfall.

Owner:YOUNG ROBERT A

Methods and systems for providing liquidity options and permanent legacy benefits for annuities

Owner:NEW YORK LIFE INSURANCE COMPANY

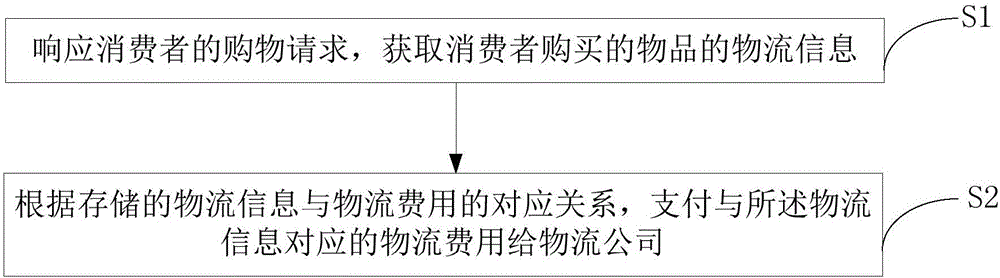

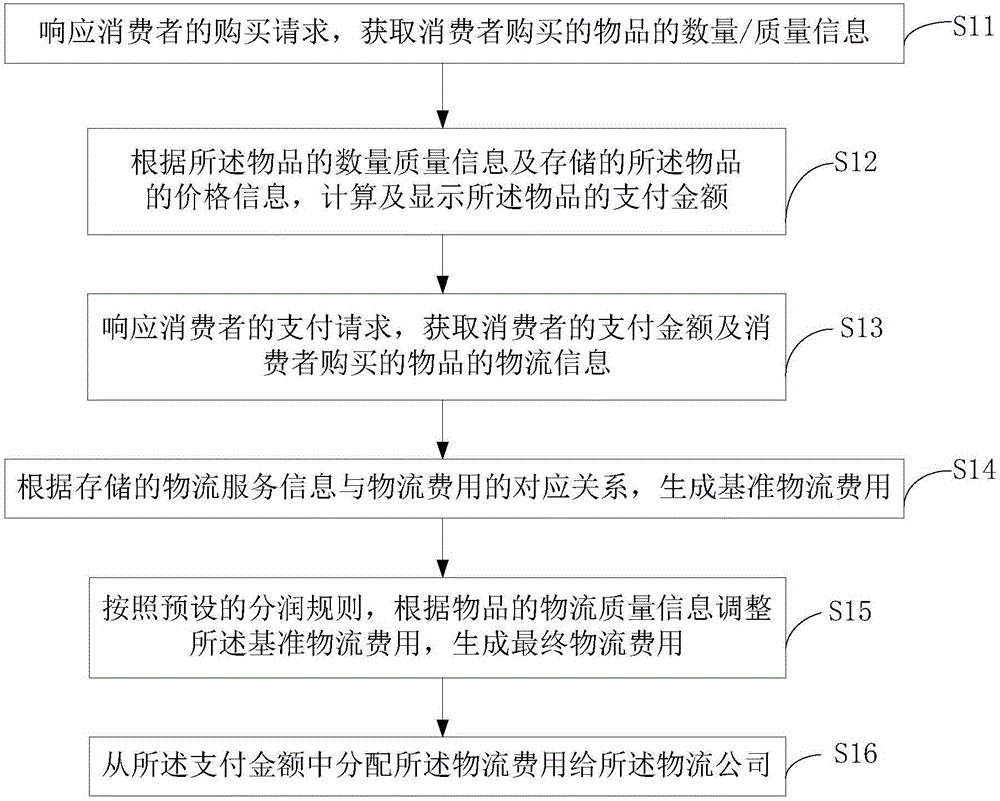

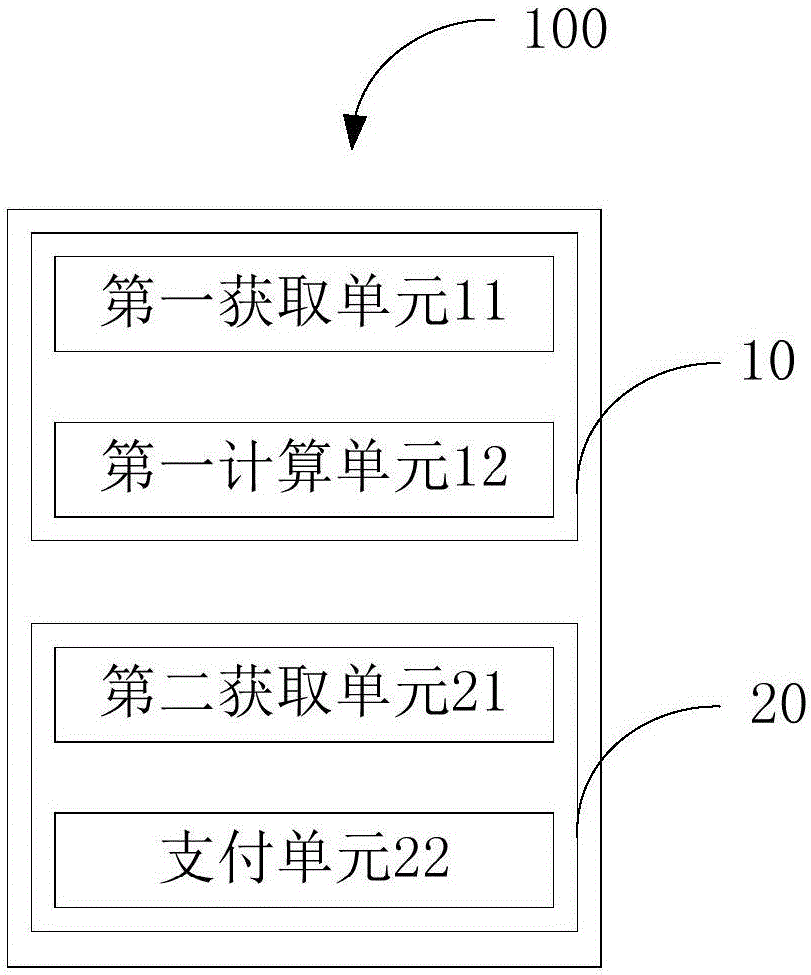

Logistics payment method and system

InactiveCN106803170AEase economic pressureEasy turnoverPayment architectureLogisticsLogistics managementEconomic pressure

The invention provides a logistics payment method, including the following steps: in response to a purchase request of a consumer, obtaining logistics information of an article purchased by the consumer; and according to a corresponding relation between the stored logistics information and logistics expense, paying the logistics expense corresponding to the logistics information to a logistics company. The invention also provides a logistics payment system. According to the logistics payment method and system, logistics expense that a merchant needs to pay is directly deducted from purchase expense paid by a consumer, thereby omitting economic communication between the merchant and a logistics company, enabling payment of the logistics expense to be fragmentized, relieving economic pressure of the merchant brought by one-off payment, facilitating capital turnover of the merchant, and promoting the development of the logistics industry to some extent.

Owner:HANGZHOU NAJIE TECH CO LTD

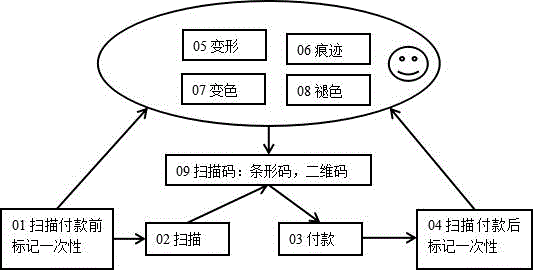

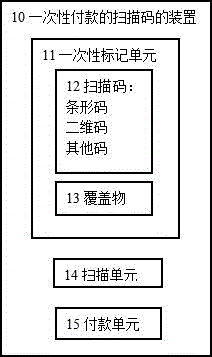

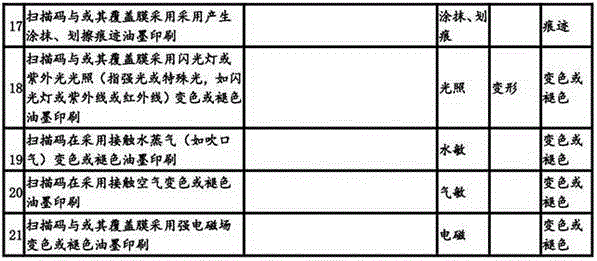

One-off payment scanning code method, apparatus and system

InactiveCN106779680AAvoid or remind re-scan paymentsEasy to participatePayment architectureGraphicsTime mark

The invention discloses a one-off payment scanning code method, apparatus and system. The method comprises scanning and payment steps, and further comprises a one-time marking step which enables a scanning code and / or a covering of the scanning code to be subjected to visible and unrecoverable physical change. The physical change includes but not limited to deformation, color change, color fading and traces; and a physical change mode includes but not limited to a mode of using one or a combination of multiple of hands, light, gas and electromagnetism. The apparatus is characterized by further comprising a one-time marking unit. The system comprises the one-off payment scanning code apparatus. The scanning code includes but not limited to barcodes, graphs, images, and texts; and the barcodes include one-dimensional and two-dimensional codes. By adopting the one-off payment scanning code method, apparatus and system, repeated scanning code payment of users is prompted or prevented, and the technical problem of the repeated scanning code payment of the users is solved; and therefore, the one-off payment scanning code method, apparatus and system has extremely high commercial application value and prospect.

Owner:赵化宾

System and method for financial product management

Owner:HARTFORD FIRE INSURANCE

Long-term property acquisition and payment method

PendingUS20140236754A1Shorten the durationReduce the numberFinanceBuying/selling/leasing transactionsLump sumComputer science

Owner:FRATTALONE NICHOLAS

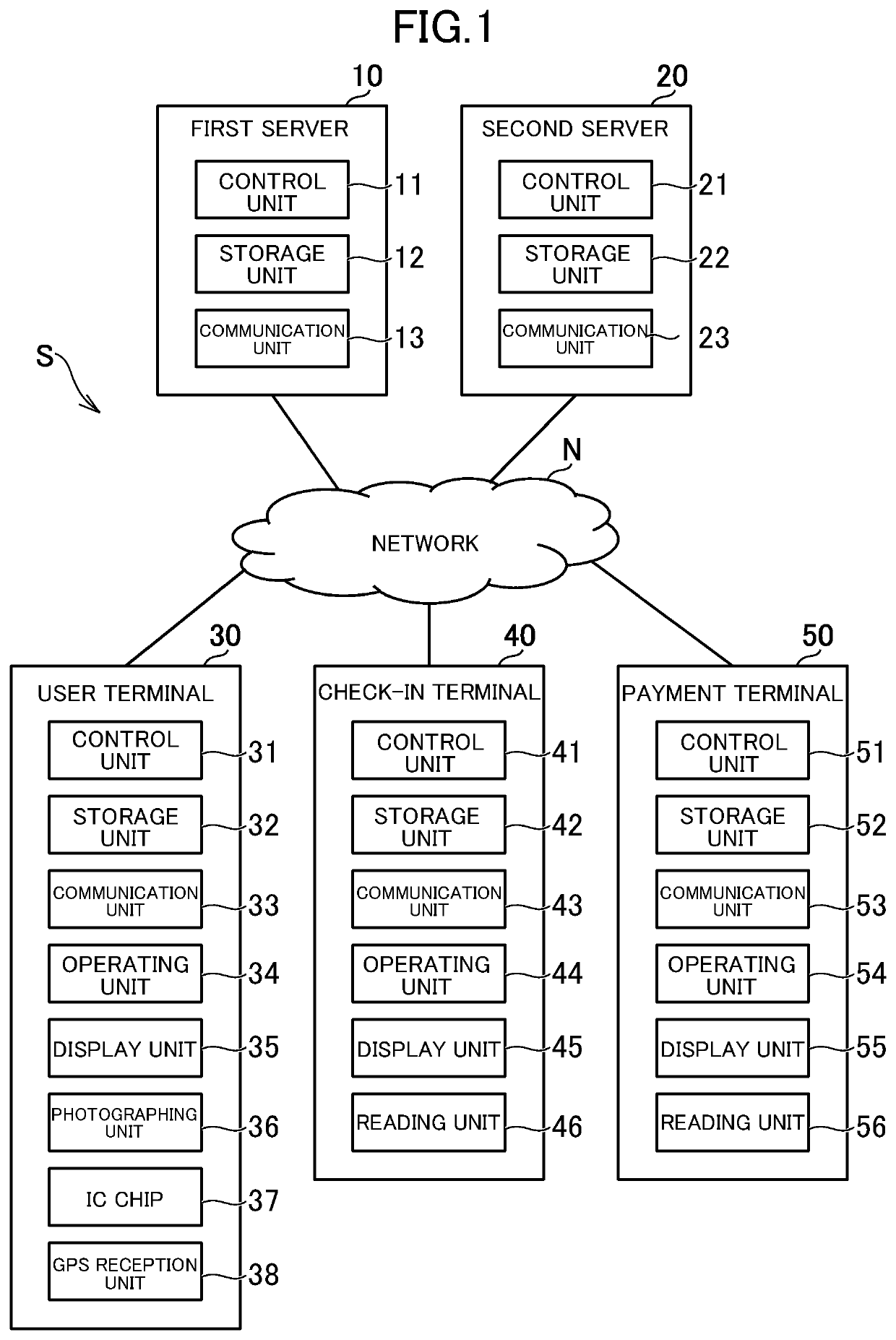

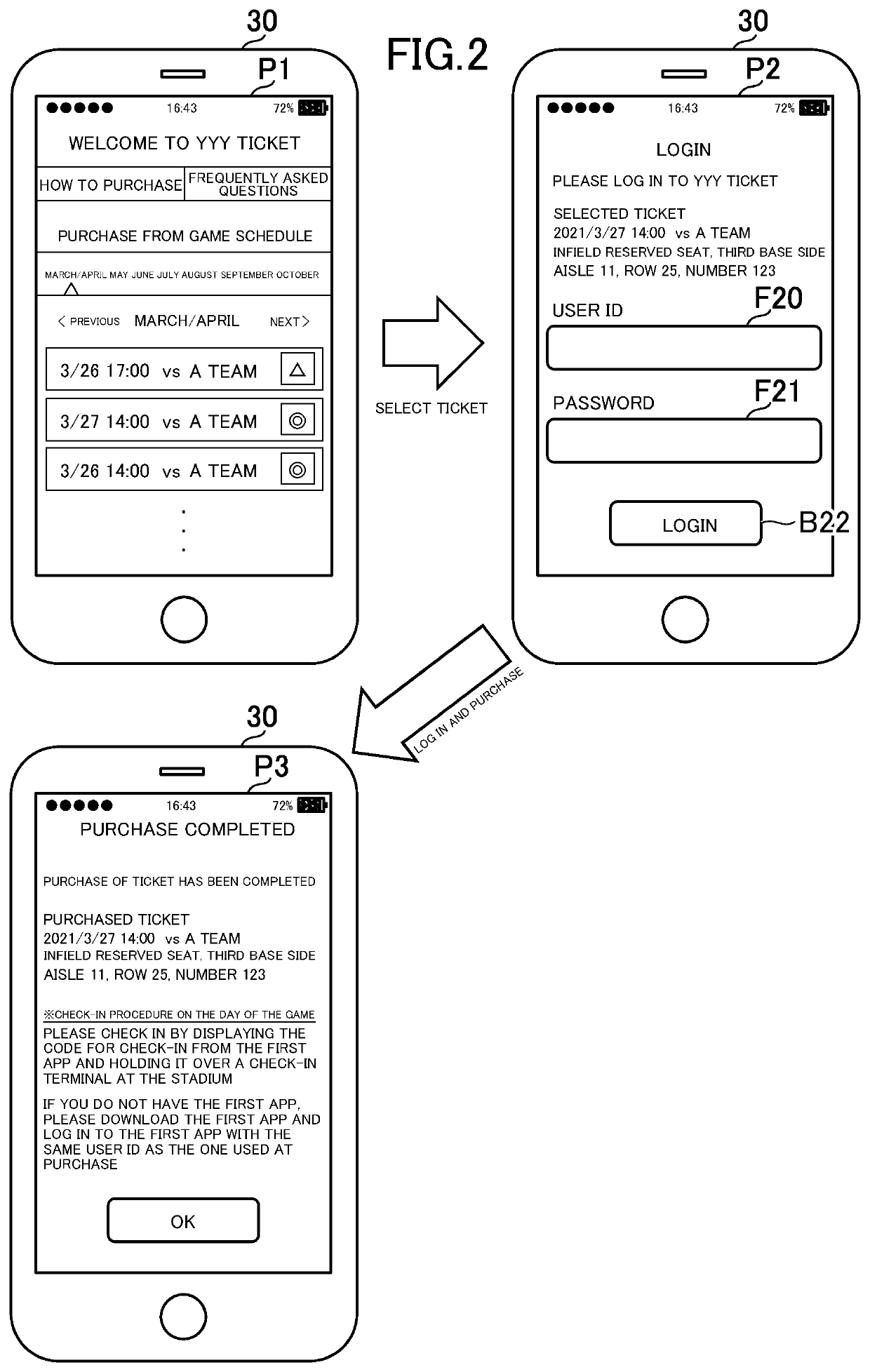

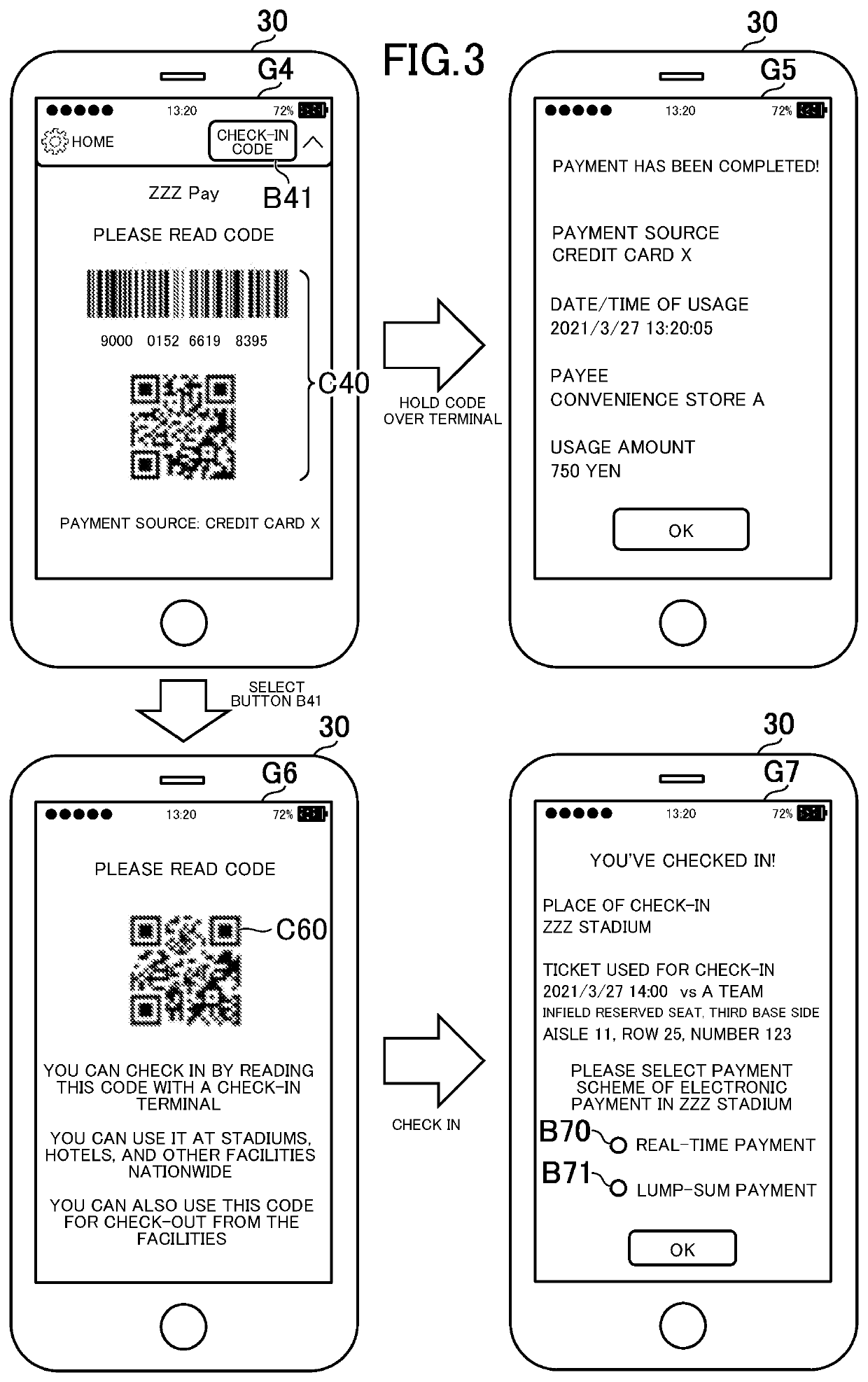

Electronic payment system, electronic payment method, and information storage medium

PendingUS20220318884A1Improve conveniencePayment architectureBuying/selling/leasing transactionsComputer networkEngineering

Provided is an electronic payment system which receives a payment request for electronic payment when a user visits a predetermined place to use a series of services, the electronic payment system including at least one processor configured to: determine, depending on the user, which one of real-time payment to be executed for each payment request or lump-sum payment to be collectively executed for a plurality of payment requests is to be executed; and execute one of the real-time payment or the lump-sum payment based on a result of the determination.

Owner:RAKUTEN GRP INC

Disposable payment account

InactiveUS20140207656A1Improve securityLimiting financial exposureFinancePayment circuitsAuthorizationLump sum

Methods are provided of processing a transaction between a consumer and a merchant with a disposable financial account. The disposable financial account is created automatically at a financial institution upon receipt of information provided by the consumer requesting creation of the account through an interface with the financial institution. The consumer is provided with information identifying the disposable financial account through the interface. An authorization request for the transaction is received from the merchant over a financial processing network. The authorization request includes the information identifying the disposable financial account and a transaction amount. An approval for the authorization request is returned to the merchant over the financial processing network based on financial parameters of the disposable financial account. Funds are transferred from the disposable financial account corresponding to the transaction amount to control of the merchant. The disposable financial account is automatically closed after satisfaction of a predetermined condition.

Owner:FIS PAYMENTS LLC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com