Patents

Literature

66results about How to "Accelerating transaction" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

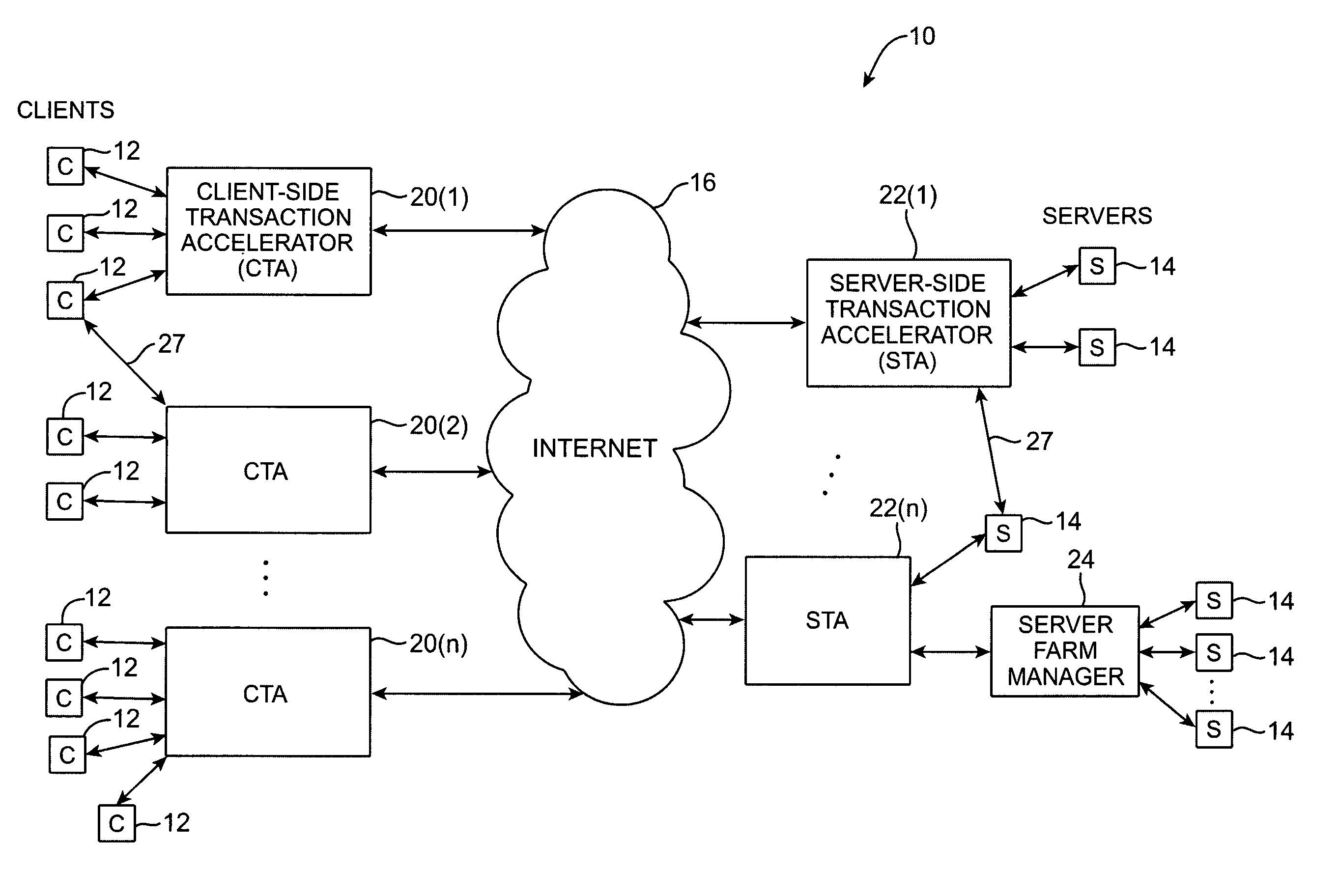

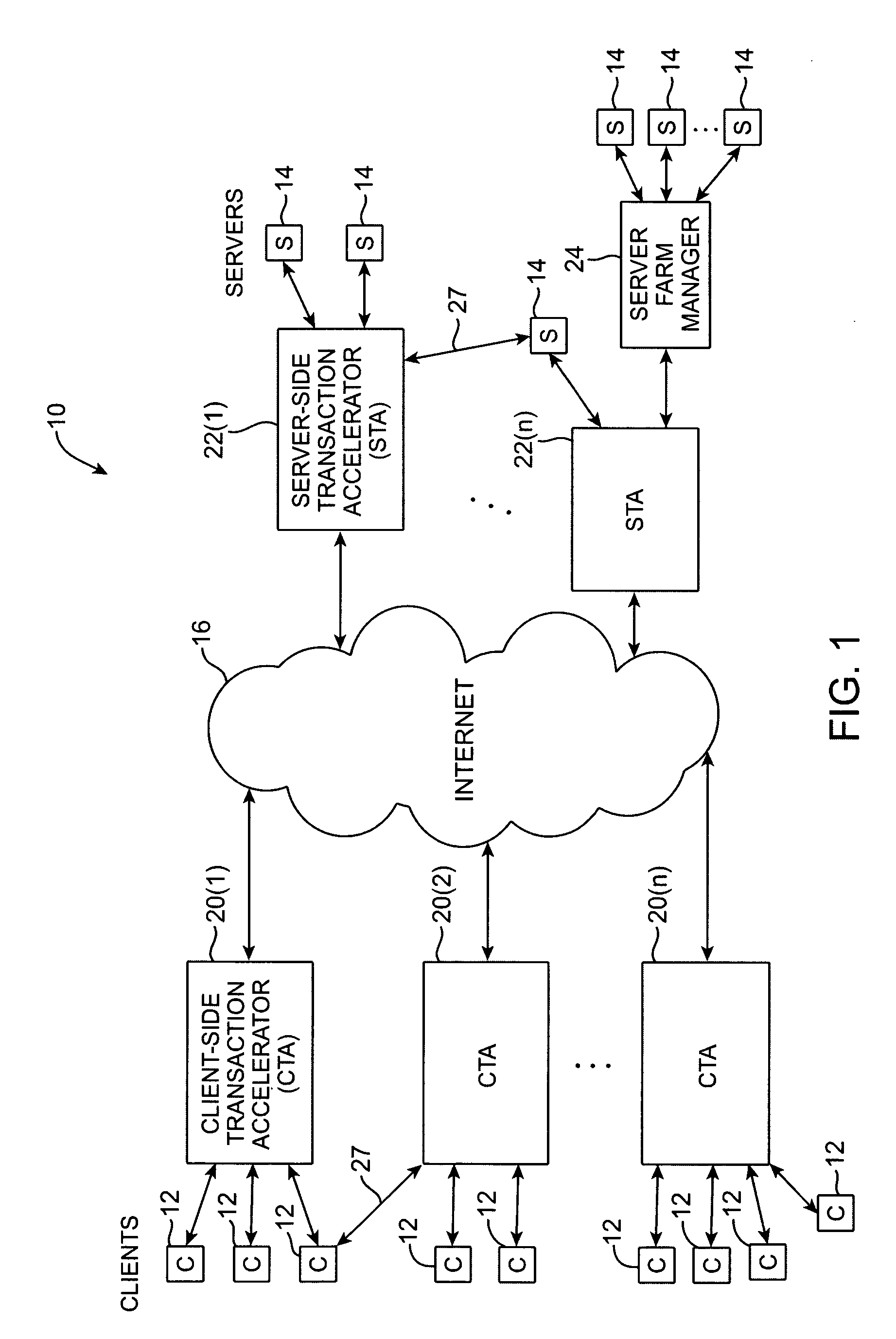

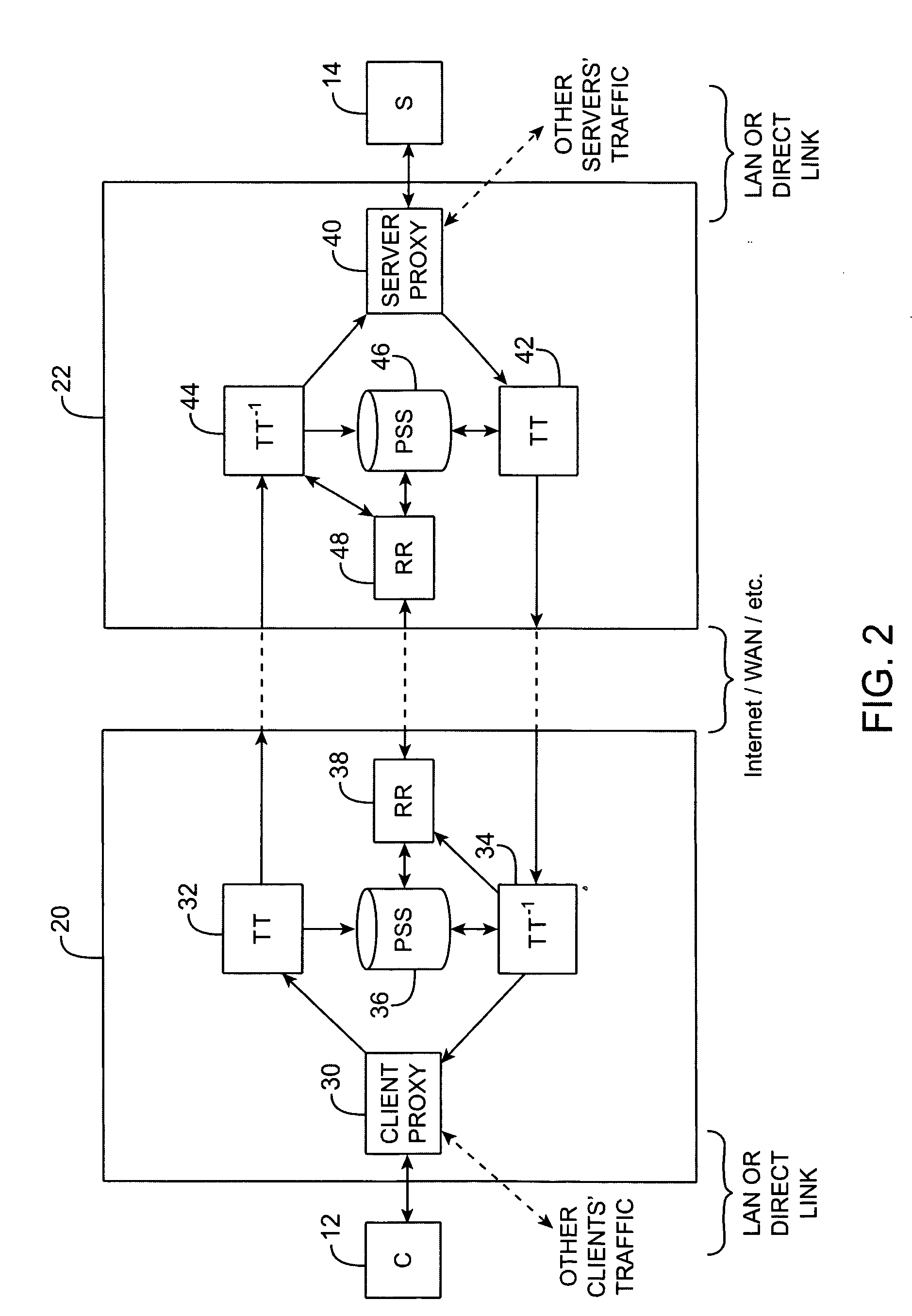

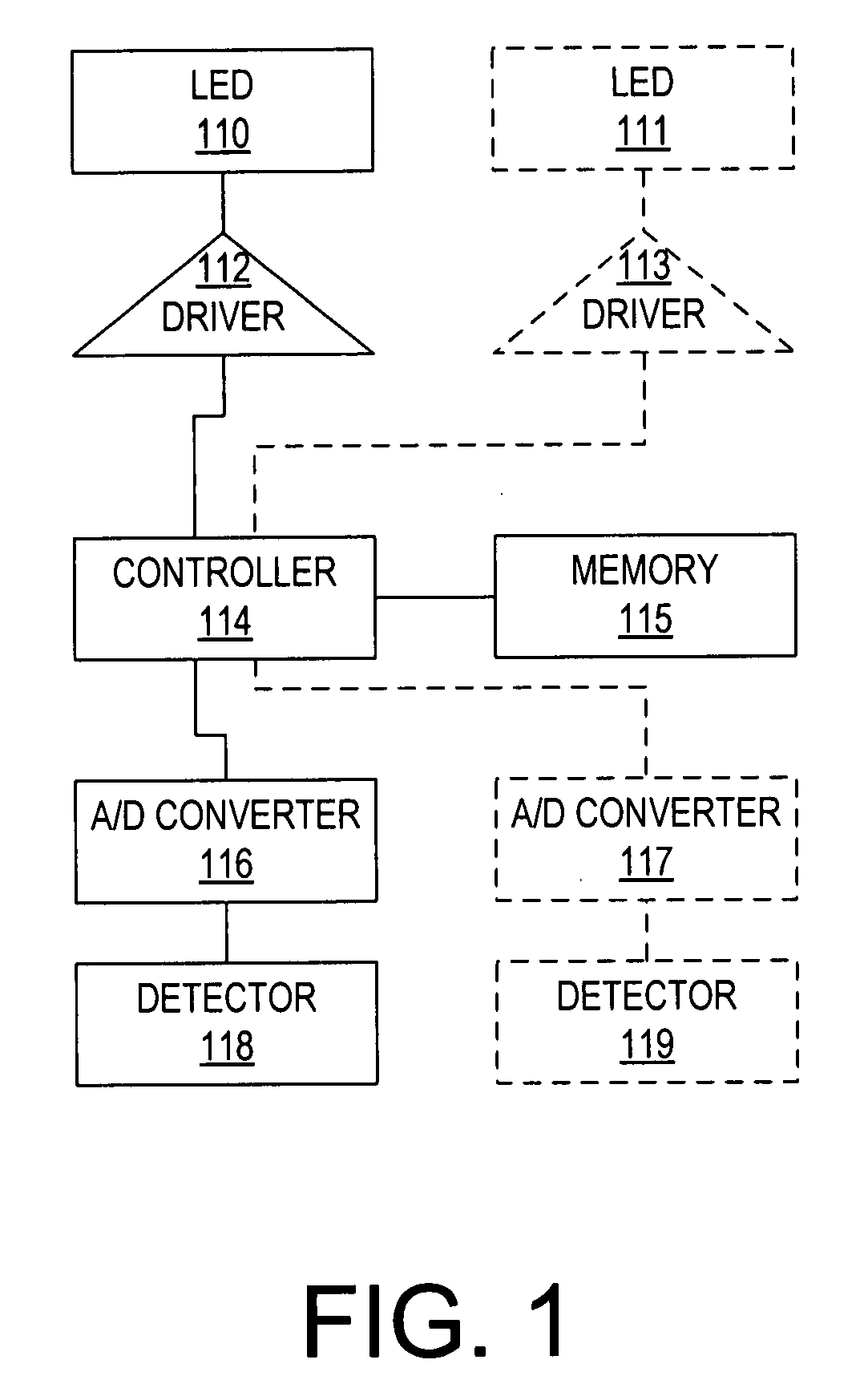

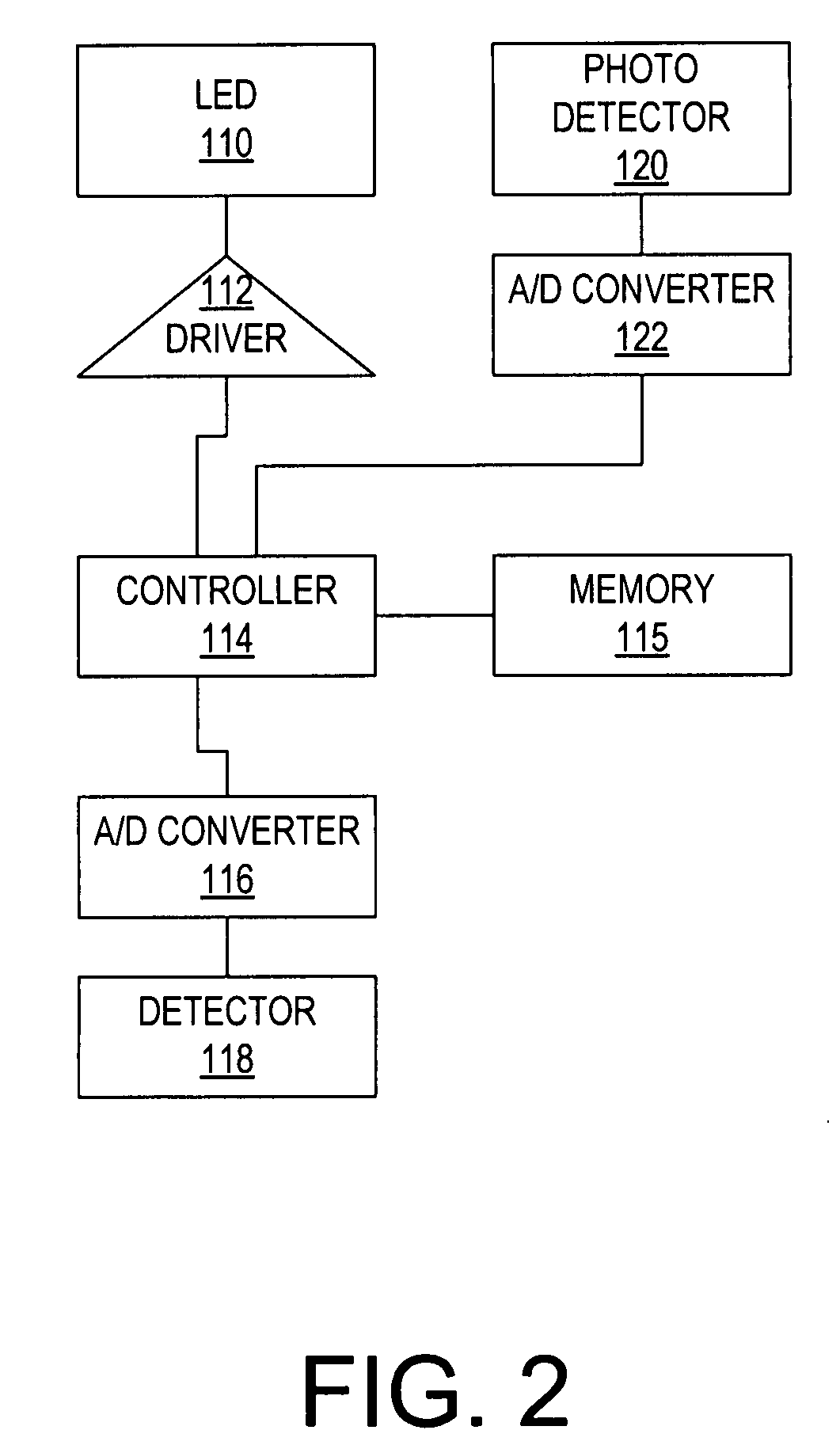

Transaction accelerator for client-server communication systems

InactiveUS7120666B2Reduce network bandwidth usageAccelerating transactionIndividual digits conversionMultiple digital computer combinationsCommunications systemClient-side

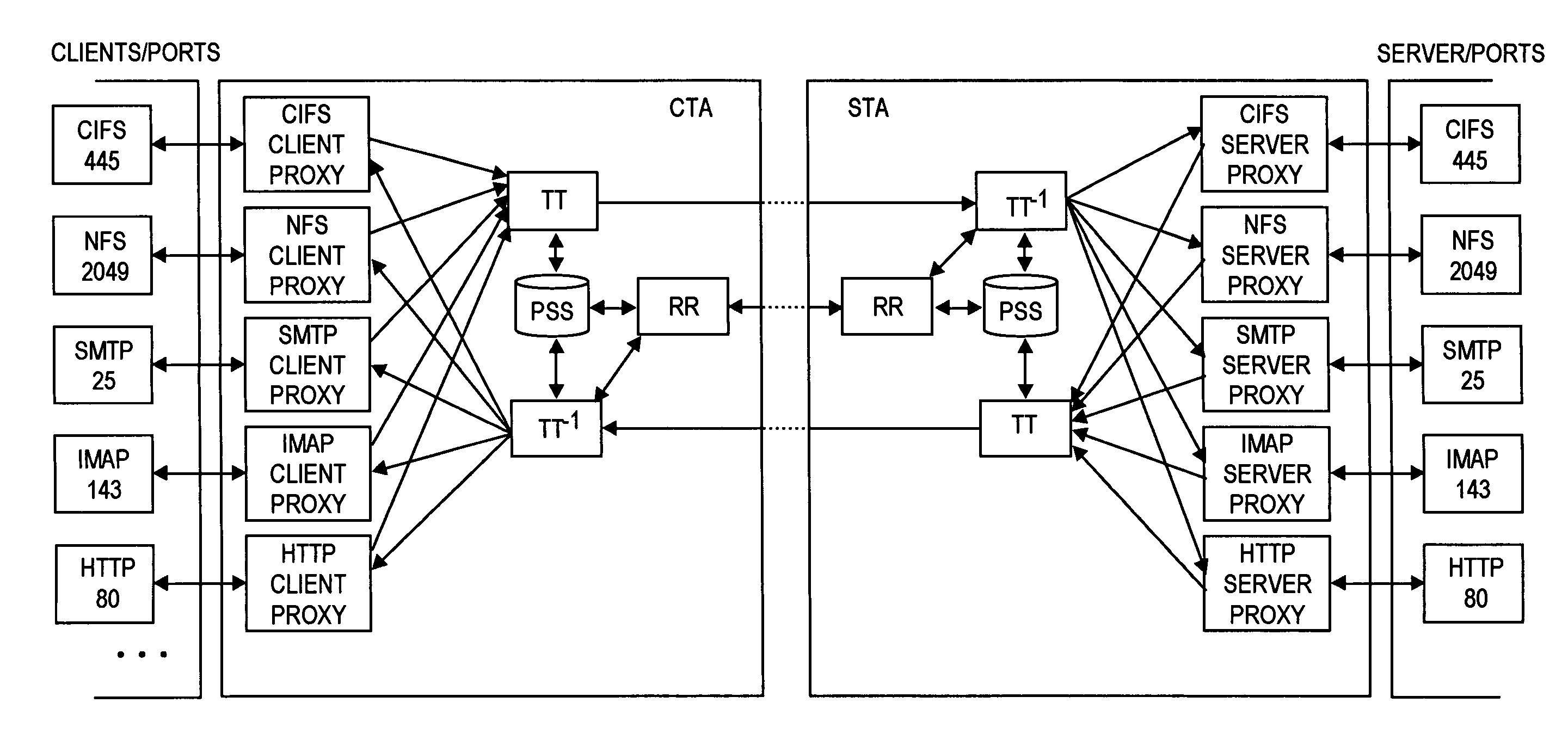

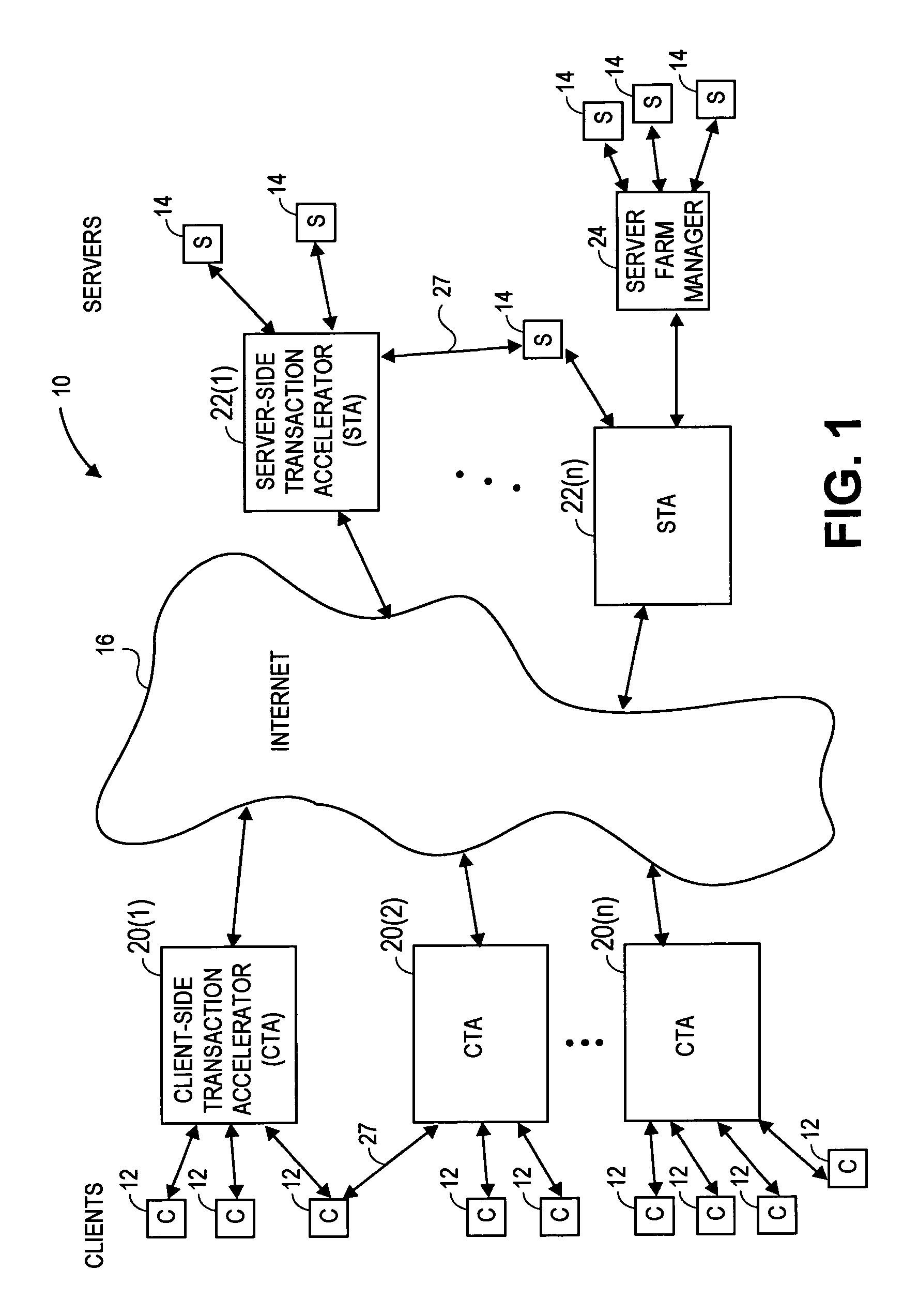

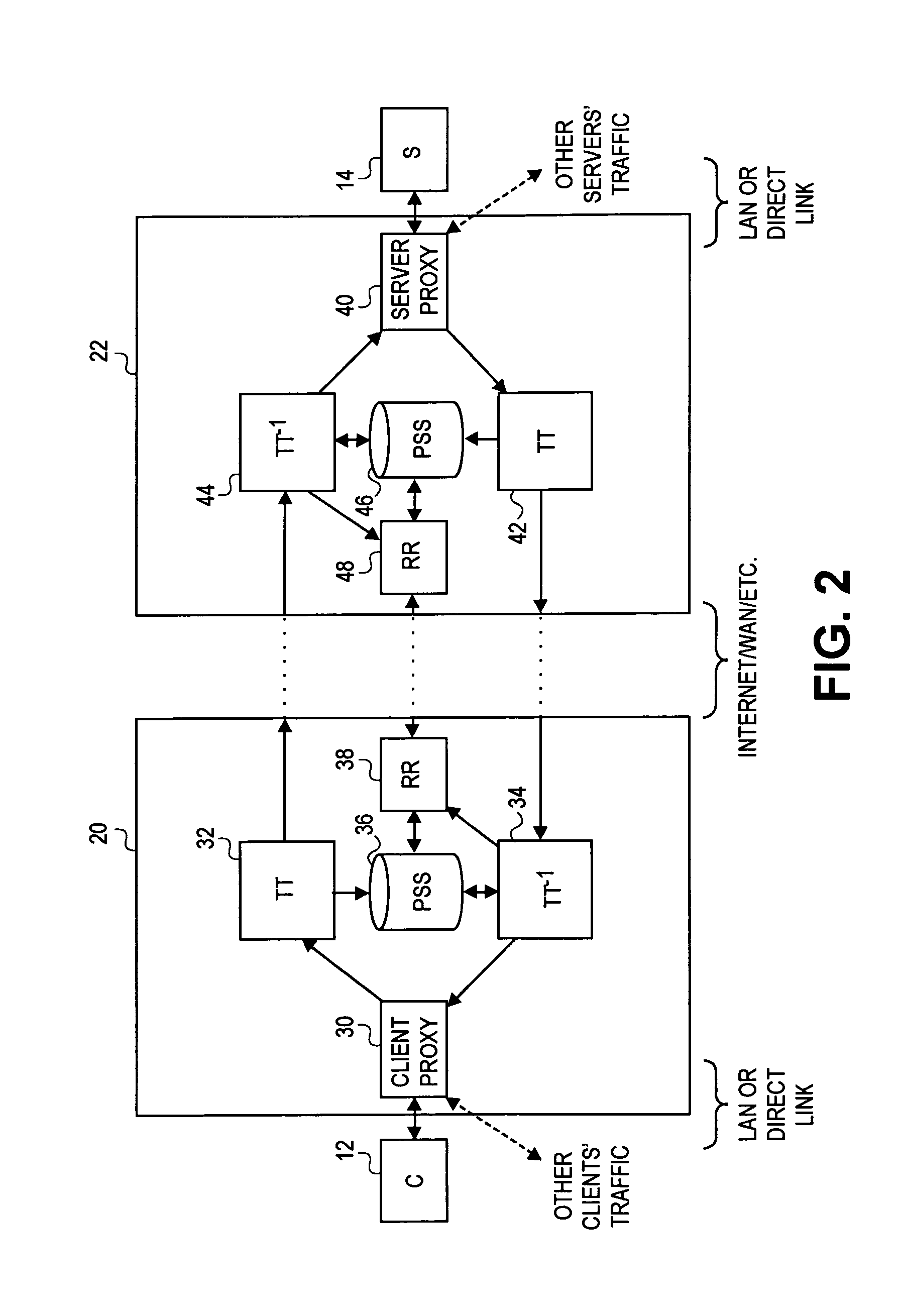

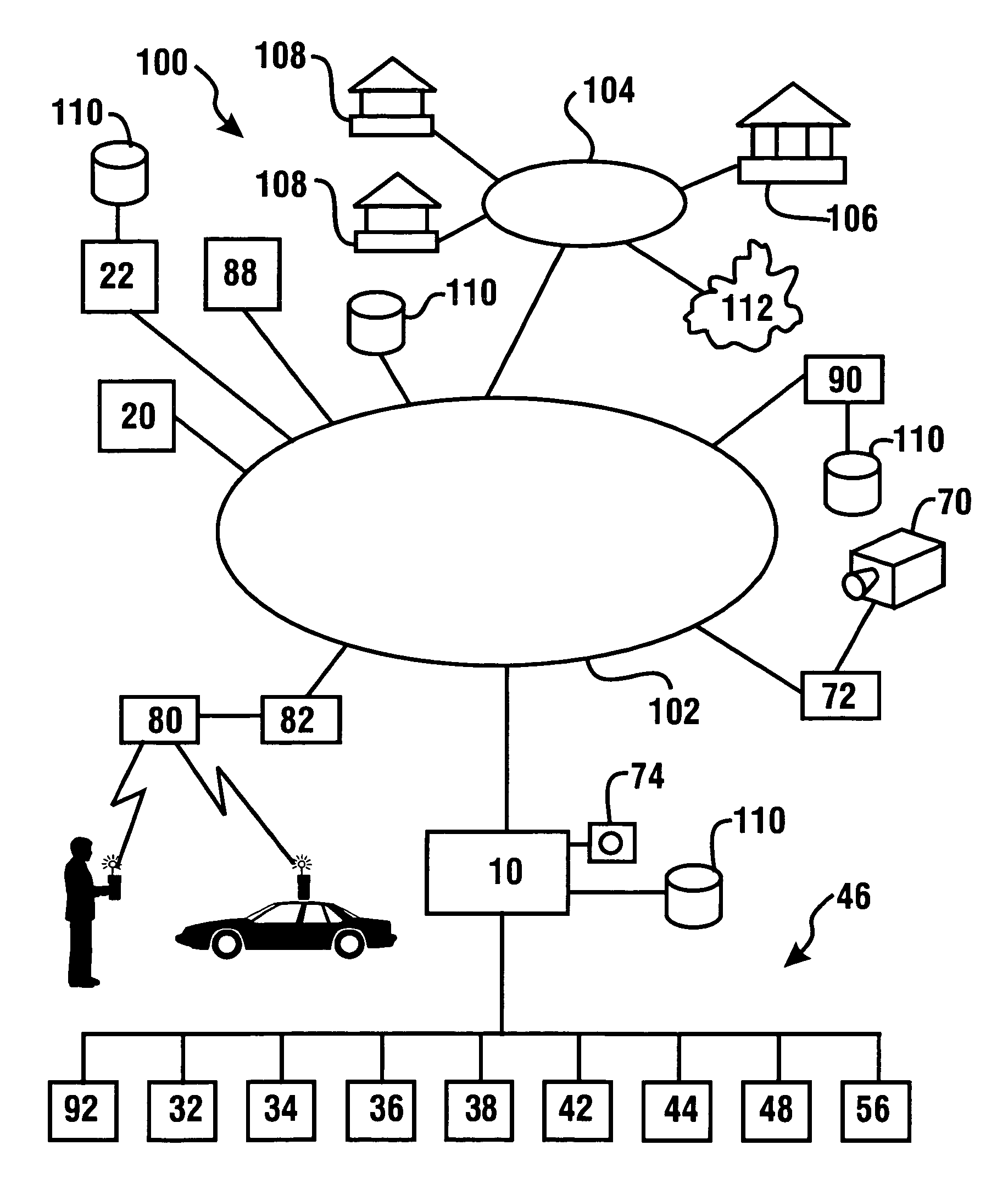

In a network having transaction acceleration, for an accelerated transaction, a client directs a request to a client-side transaction handler that forwards the request to a server-side transaction handler, which in turn provides the request, or a representation thereof, to a server for responding to the request. The server sends the response to the server-side transaction handler, which forwards the response to the client-side transaction handler, which in turn provides the response to the client. Transactions are accelerated by the transaction handlers by storing segments of data used in the transactions in persistent segment storage accessible to the server-side transaction handler and in persistent segment storage accessible to the client-side transaction handler. When data is to be sent between the transaction handlers, the sending transaction handler compares the segments of the data to be sent with segments stored in its persistent segment storage and replaces segments of data with references to entries in its persistent segment storage that match or closely match the segments of data to be replaced. The receiving transaction store reconstructs the data sent by replacing segment references with corresponding segment data from its persistent segment storage, requesting missing segments from the sender as needed. The transaction accelerators could handle multiple clients and / or multiple servers and the segments stored in the persistent segment stores can relate to different transactions, different clients and / or different servers. Persistent segment stores can be prepopulated with segment data from other transaction accelerators.

Owner:RIVERBED TECH LLC

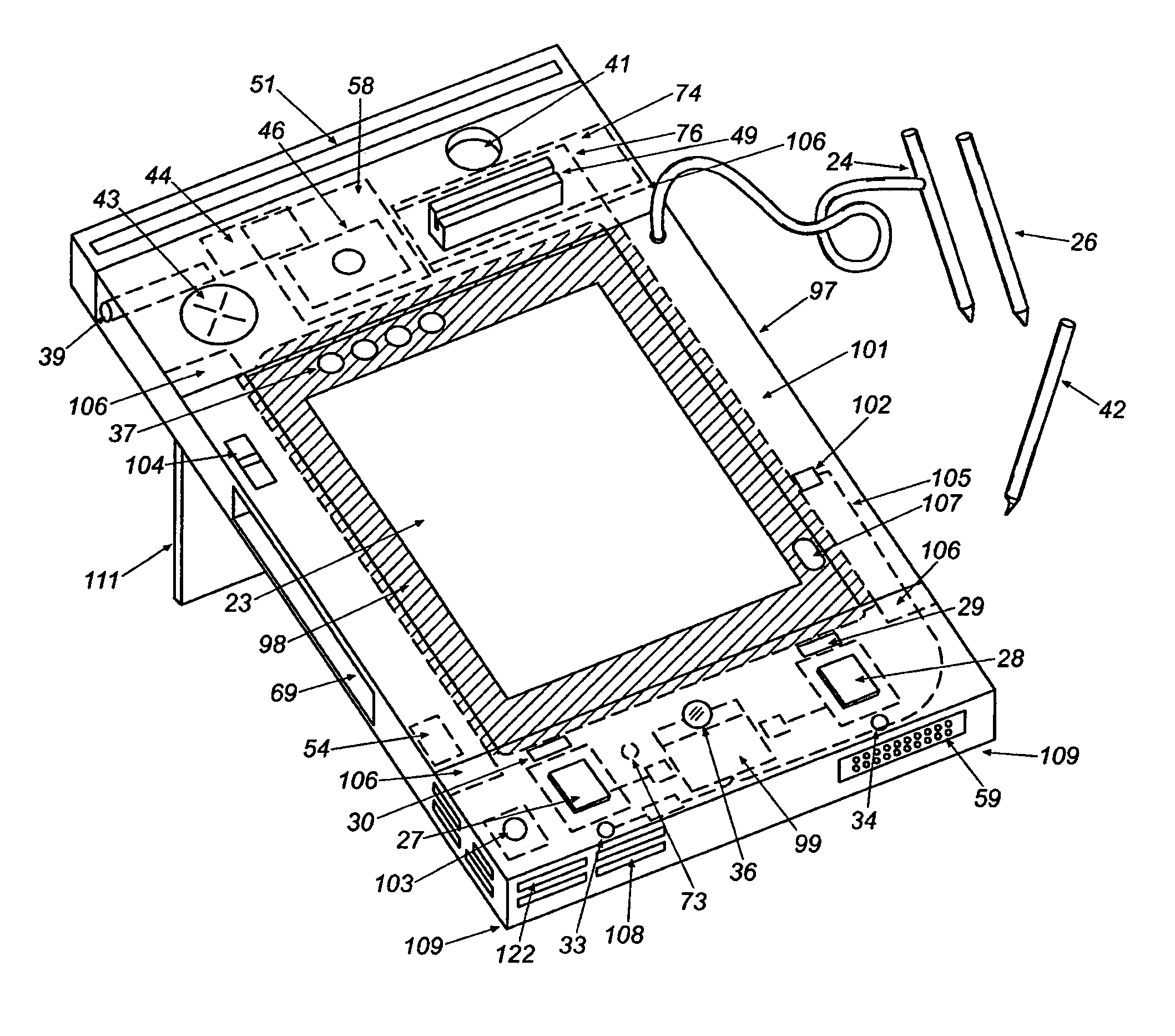

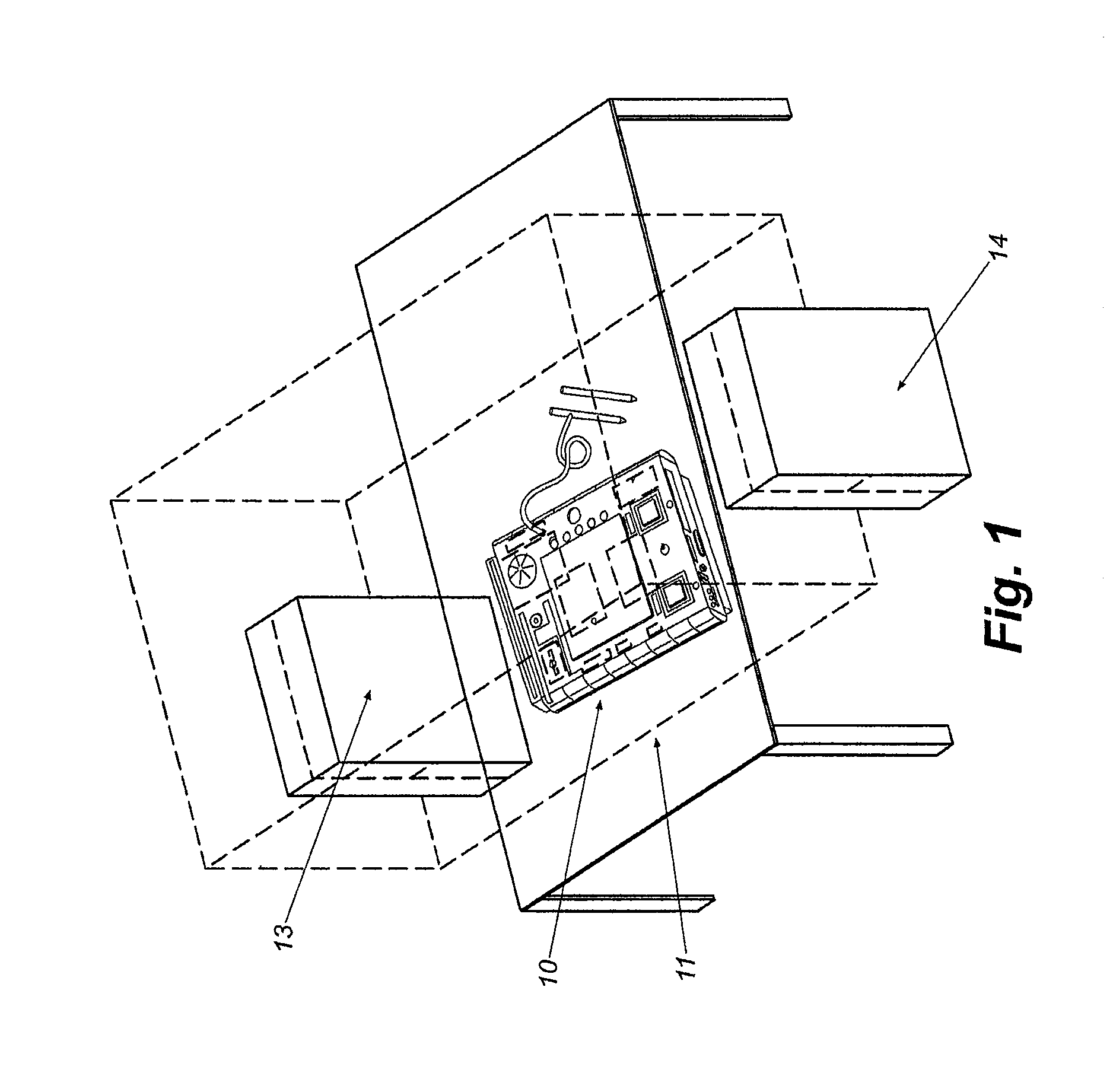

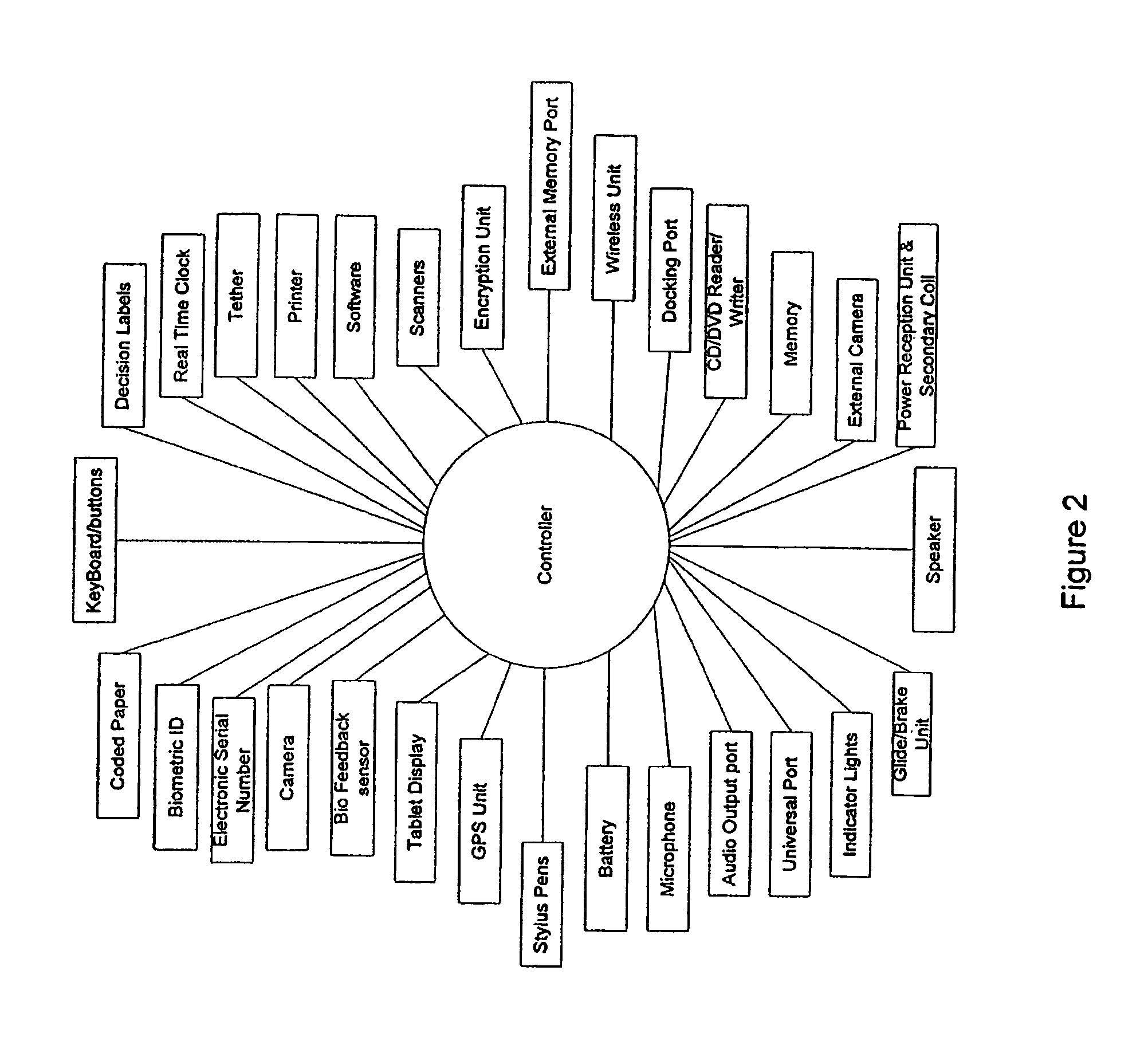

Transaction automation and archival system using electronic contract and disclosure units

ActiveUS8228299B1Shorten the timeEliminate mistakesImage analysisFinanceDisplay deviceFinancial transaction

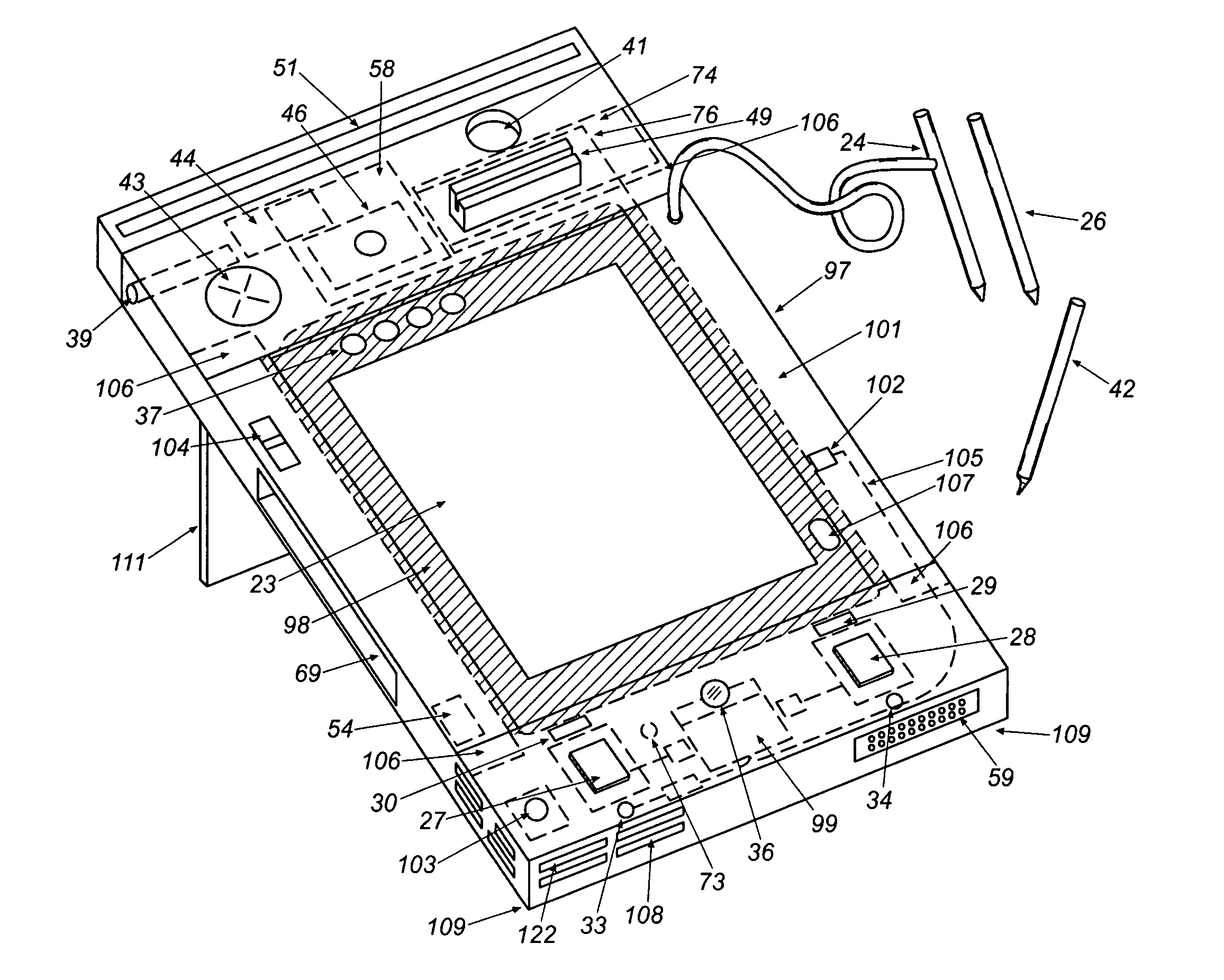

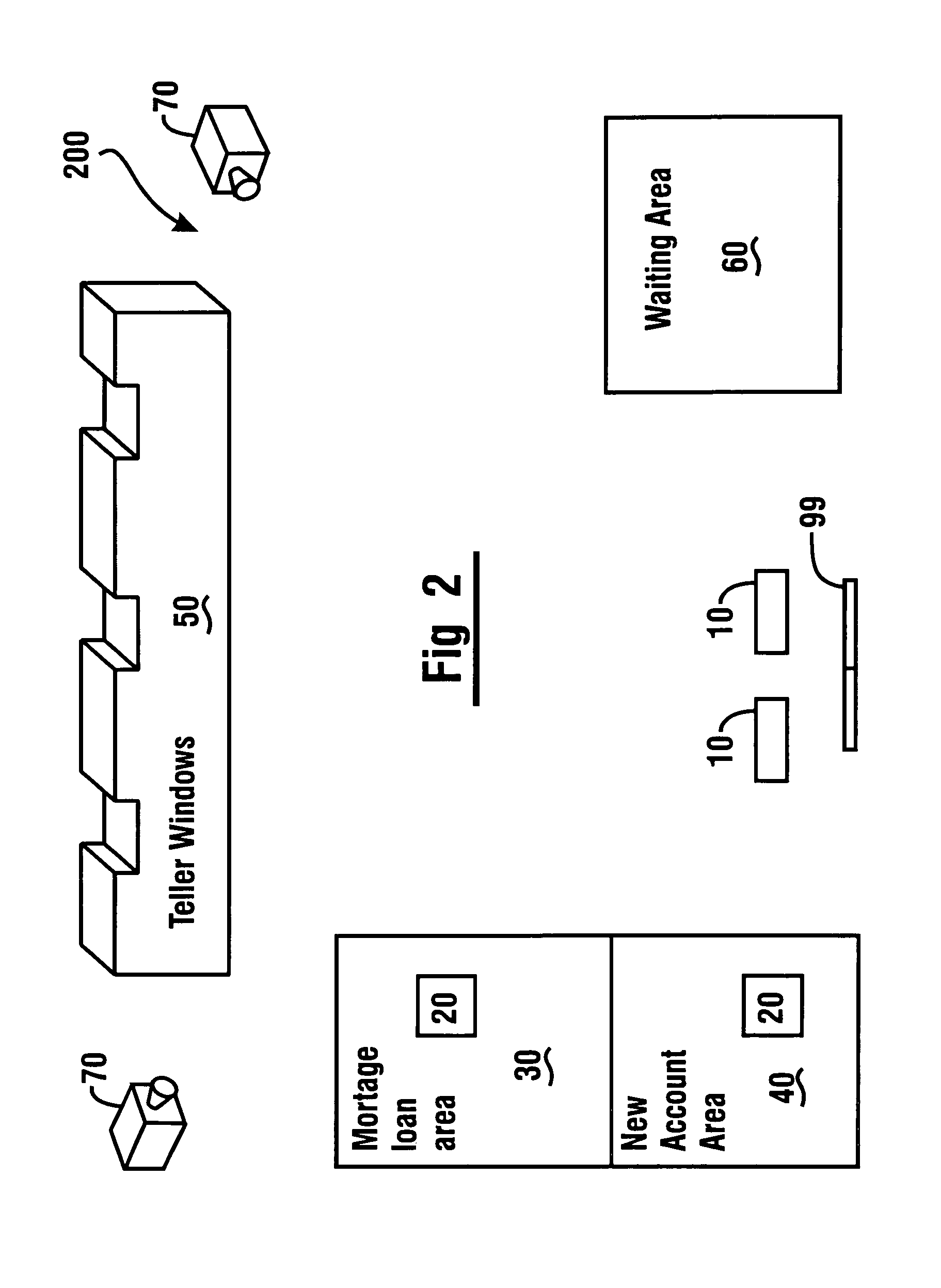

A transaction automation and archival system is provided for controlling, real-time logging, and archiving complex commercial transactions such as the purchase and financing of an automobile. The heart of the system is an electronic contract disclosure unit, or ECDU. The ECDU includes a digitizing display that includes a video display for imaging to participants the various documents involved in the transaction and a digitizer for allowing participants to sign, indicate choices, and otherwise interact directly on documents and images presented on the display. A computer controls the entire progress of the transaction, and thus controls the collaborative space occupied by the participants to the transaction. The computer, for instance, controls the order of presentation of documents to a vehicle purchaser, receives the purchaser's signature on the displayed documents when required, offers choices of various packages that can be accepted or declined by the purchaser, and insures that the entire transaction is carried out properly. The ECDU further logs the transaction for future review and preferably includes a video camera and microphone for logging images and sounds of the participants during the transaction. One or more fingerprint readers are associated with the digitizing display for allowing participants to select between options by pressing their thumb or finger on the reader, which simultaneously verifies the identity of the individual making the selection through the fingerprint.

Owner:REYNOLDS AND REYNOLDS

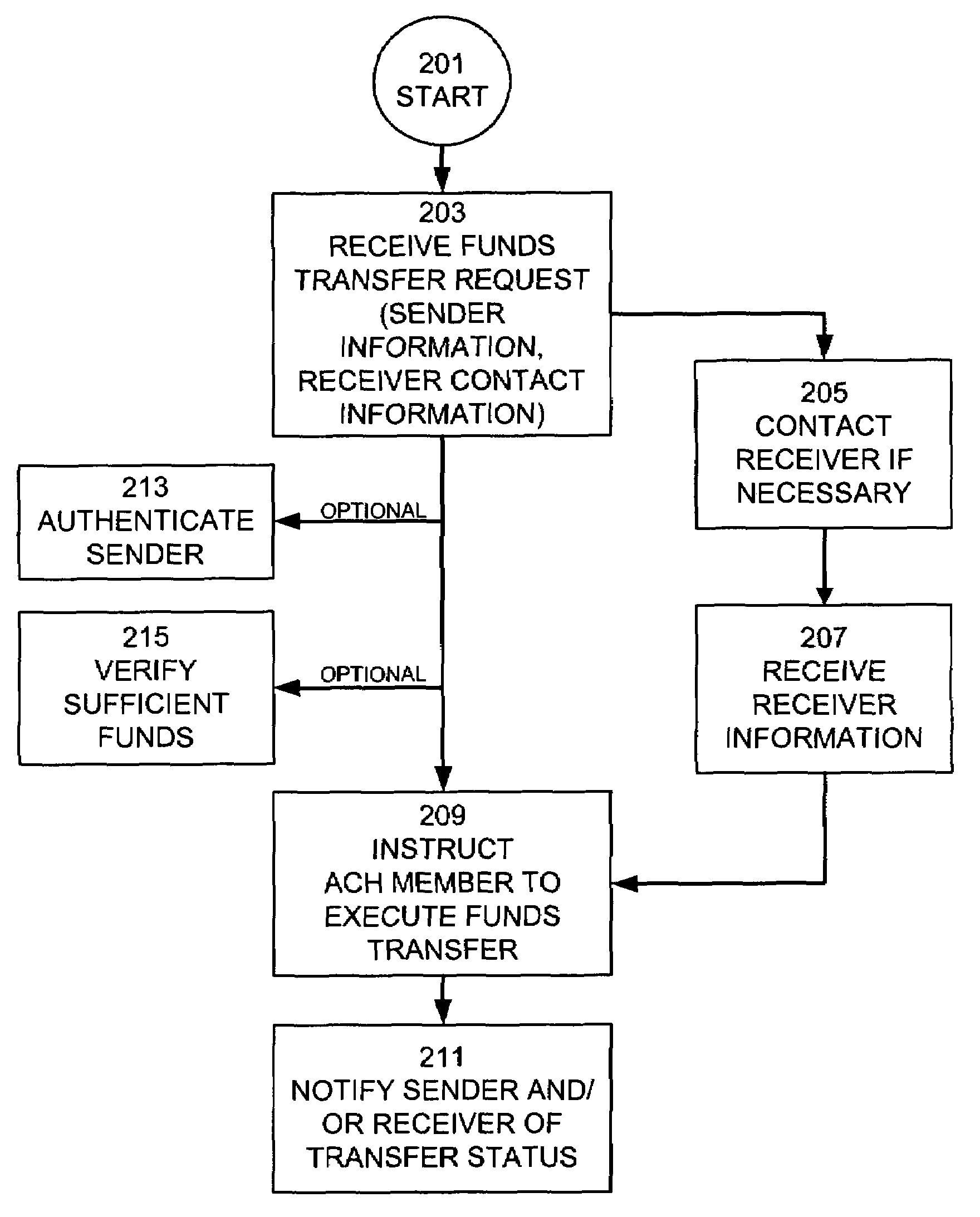

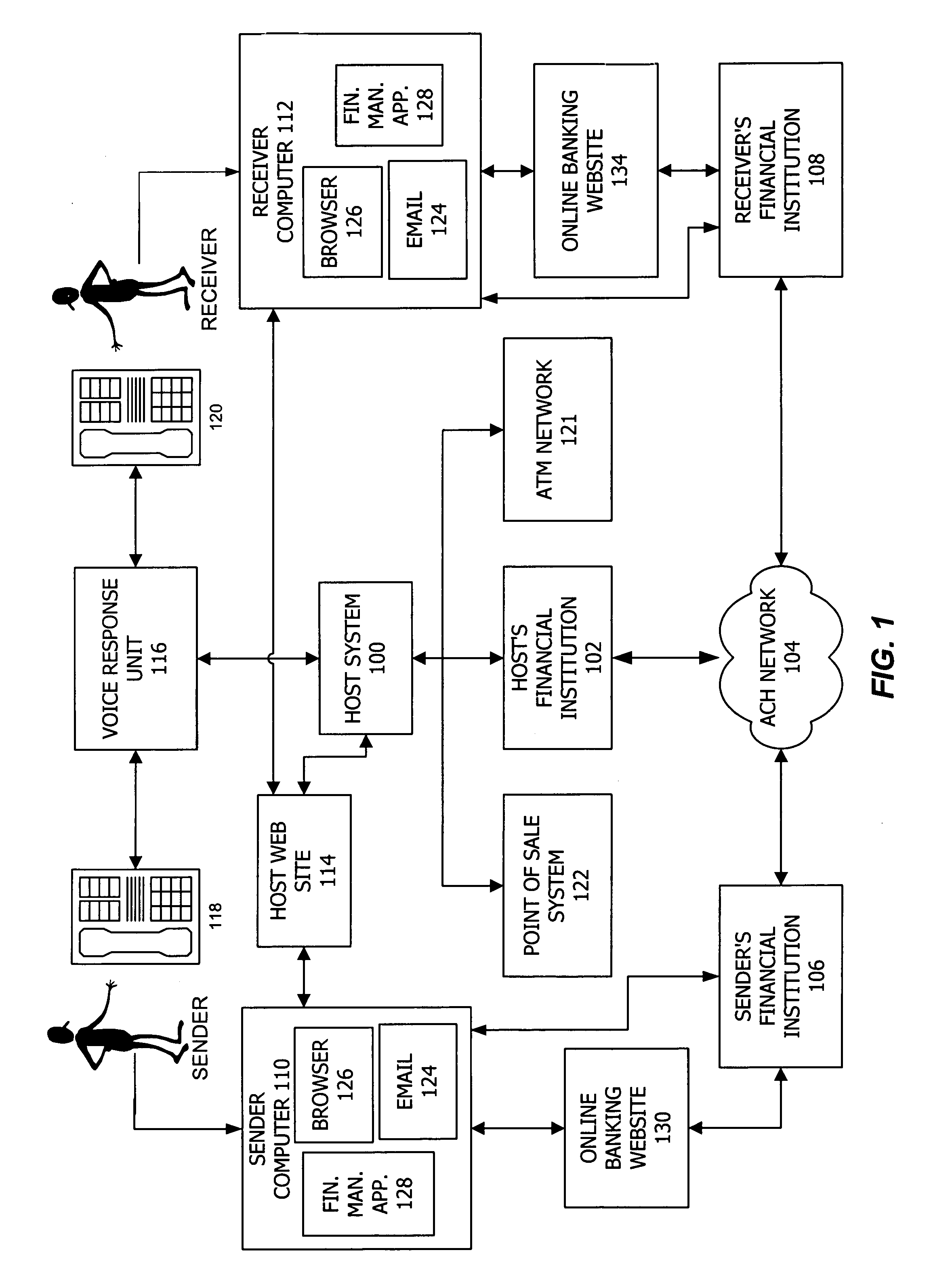

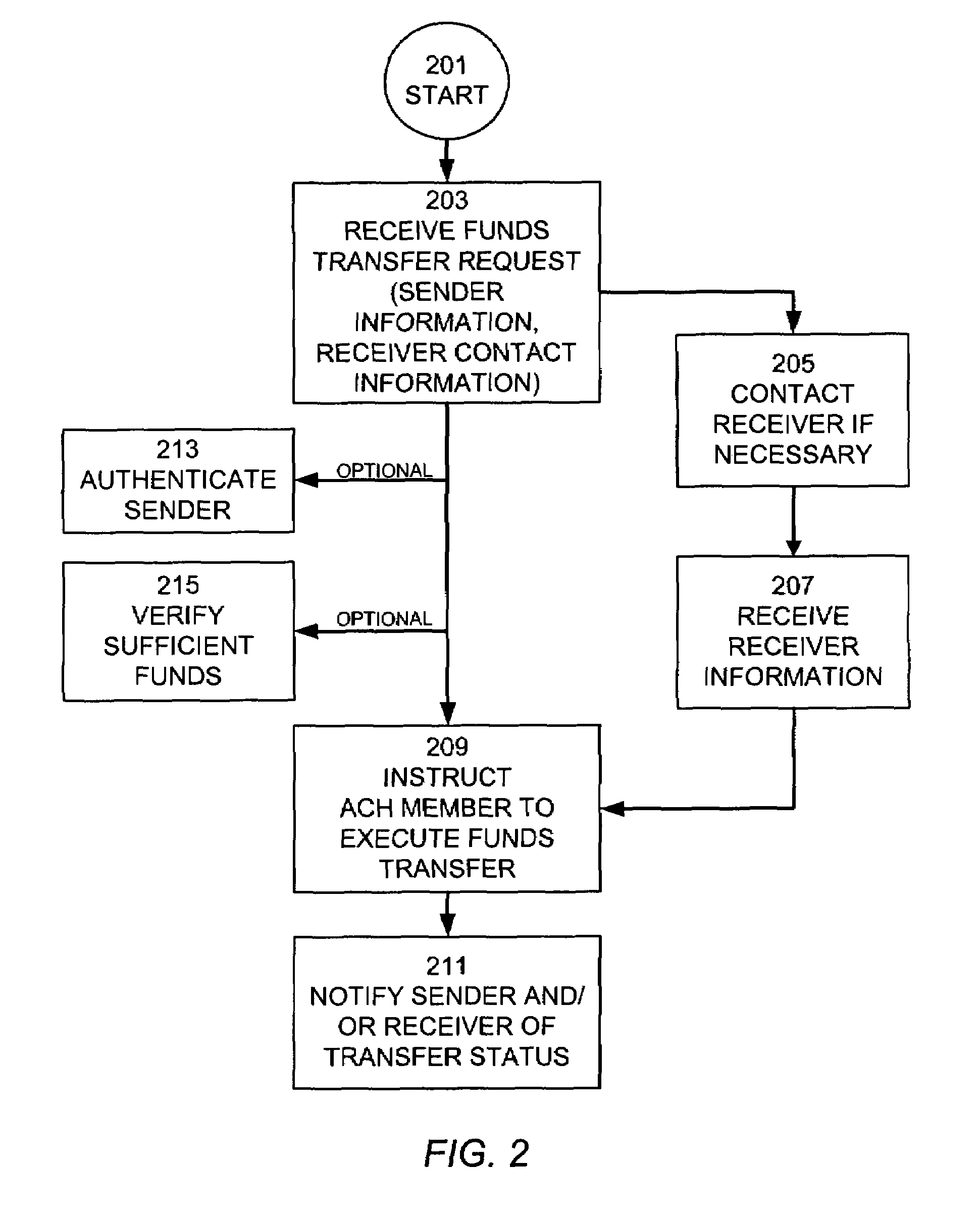

Consumer-directed financial transfers using automated clearinghouse networks

InactiveUS7395241B1Allocation is accurateEliminate contactComplete banking machinesFinanceThe InternetCheque

Consumer directed transfers of funds over the Internet are provided by a combination of systems and networks, including the Internet, email, and the Automated Clearinghouse system (ACH). A host system provided by a funds transfer service manages requests of senders to transfer funds and further manages responses of receivers to claim funds. The host system allows the sender to initiate the funds transfer by specifying the amount of the transfer and information for contacting the receiver, without the need to specify the account of the receiver for receiving the funds. Instead, the host system contacts the receiver and informs the receiver of the available funds; the receiver can then provide the necessary target account information for completing the funds transfer. The ACH is used to effect the transfer of funds, with the host system providing instructions for ACH entries to its financial institution using account information separately received from the sender and receiver. The credit risk associated with originating ACH entries is reduced by use of the Point of Sale system to verify sufficient funds in the sender's account by comparing the closing balance of the day the funds transfer is requested with the transfer amount. Sender fraud is reduced by comparing a sender provided balance (or check number / amounts) with an account balance acquired through automated means such as the POS system or ATM network.

Owner:INTUIT INC

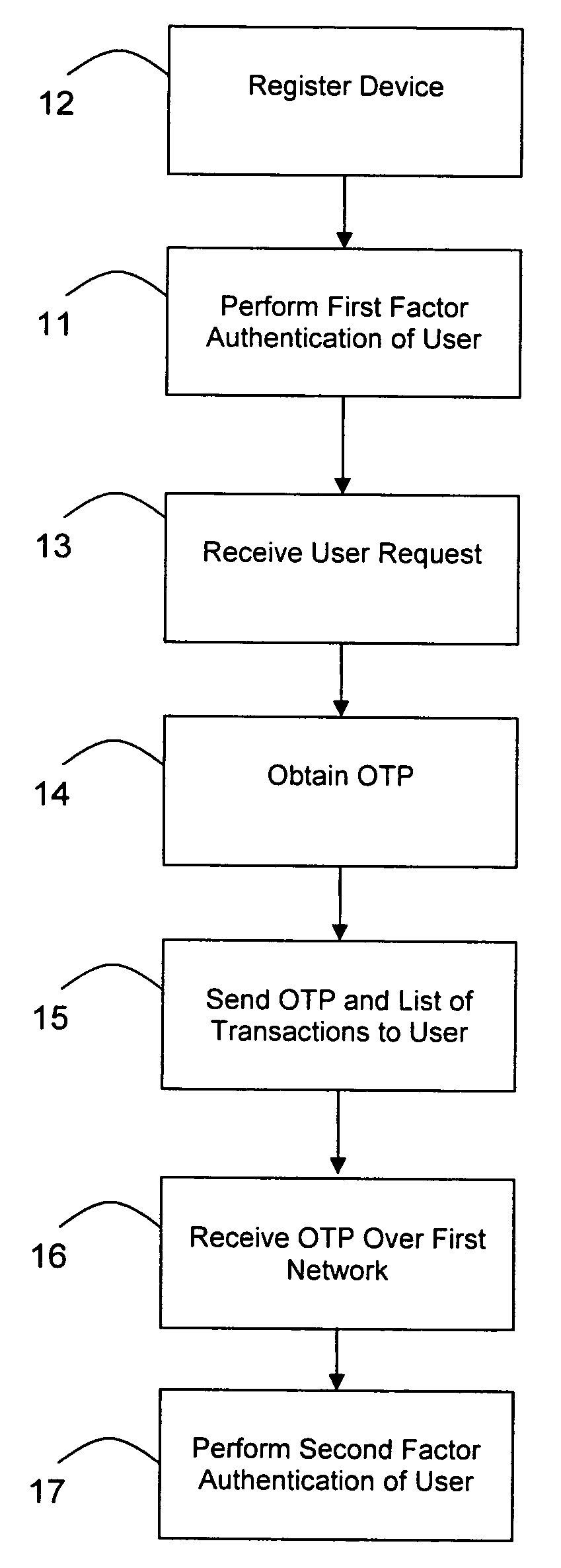

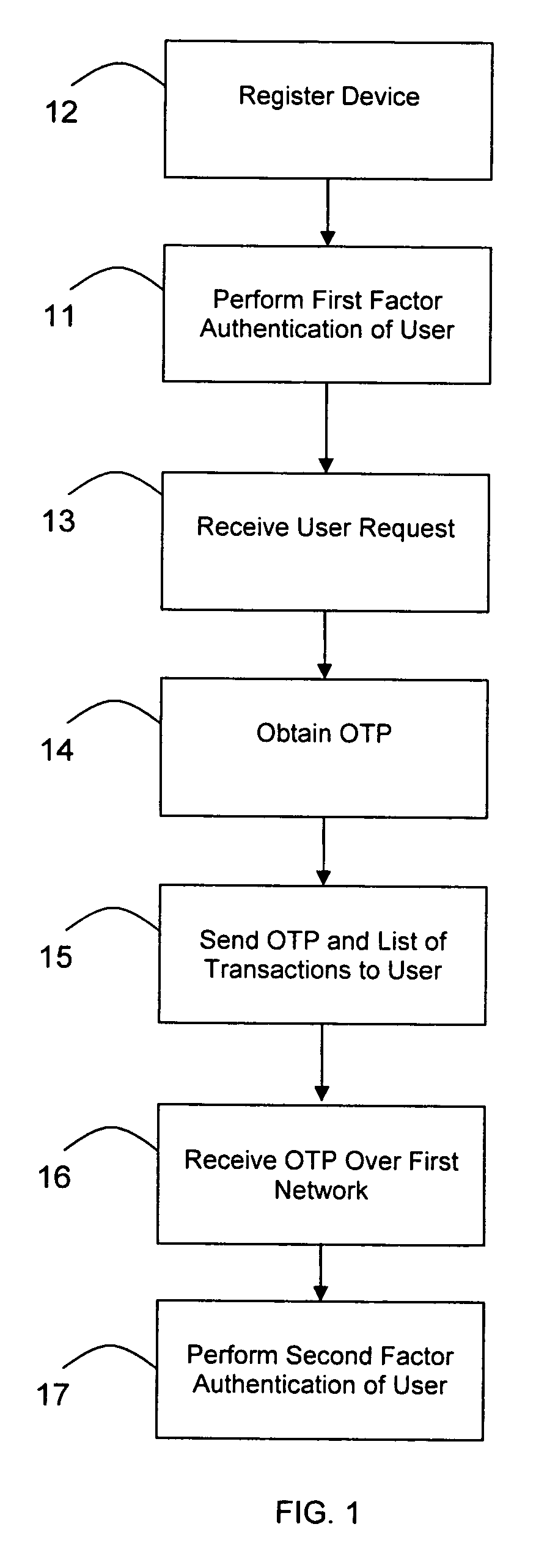

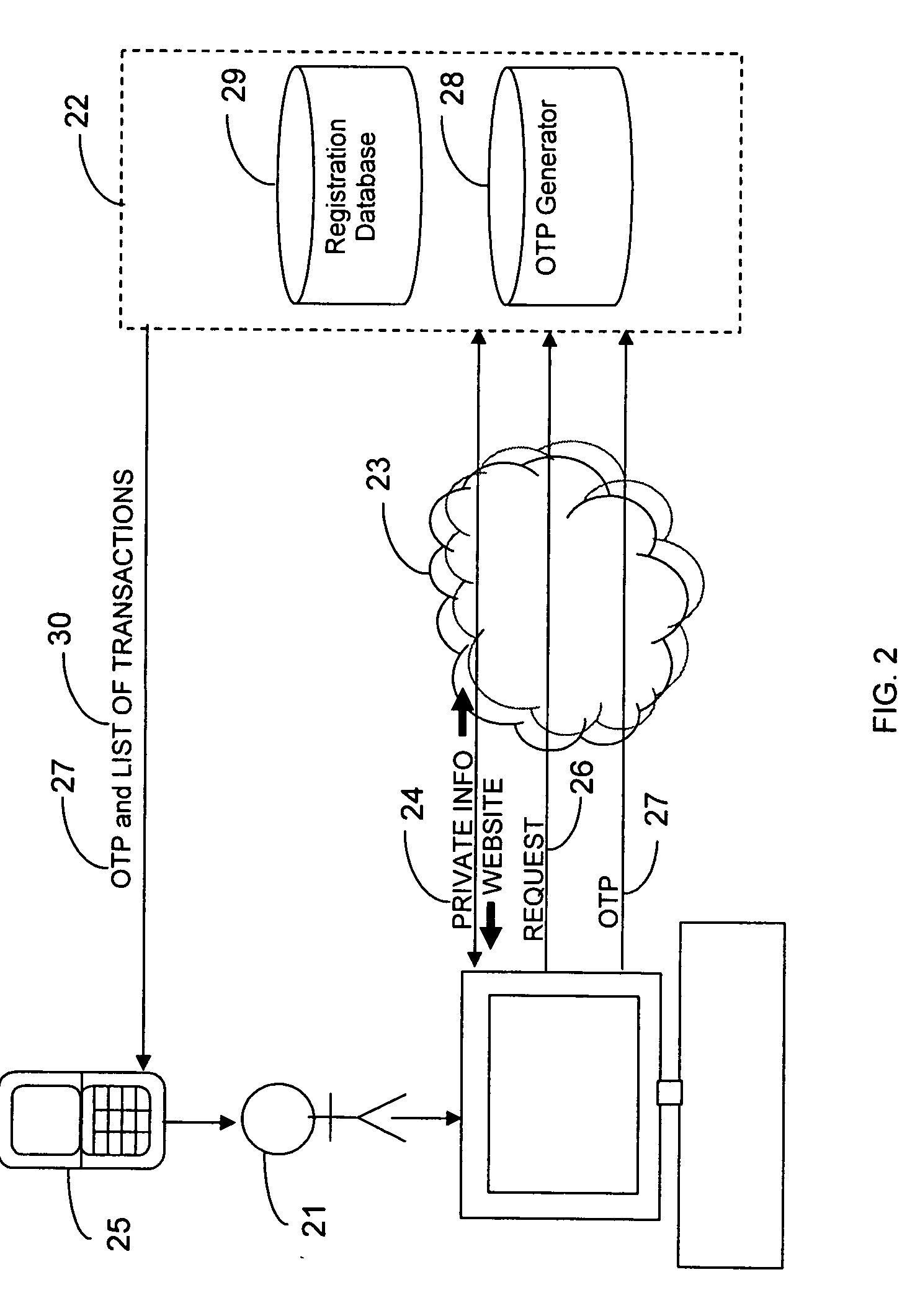

Transaction authentication over independent network

InactiveUS20090106138A1Accelerating transactionFinanceProtocol authorisationOne-time passwordCommunication device

A method of authenticating an online transaction over a first network uses 2-factor authentication of the user to defeat hacker attacks. A communication device is registered for use with the method. The communication device is configured to receive messages over a second network independent of the first network. The user is authenticated over the first network using a first factor, such as a username and password, and then initiates the transaction. A request to execute the transaction is received and a one-time password is obtained to be used as a second factor of authentication. The one-time password and details describing the transaction are sent to the communication device over the second network. The one-time password is received from the user over the first network to complete the second factor of authentication.

Owner:CLAREITY VENTURES INC

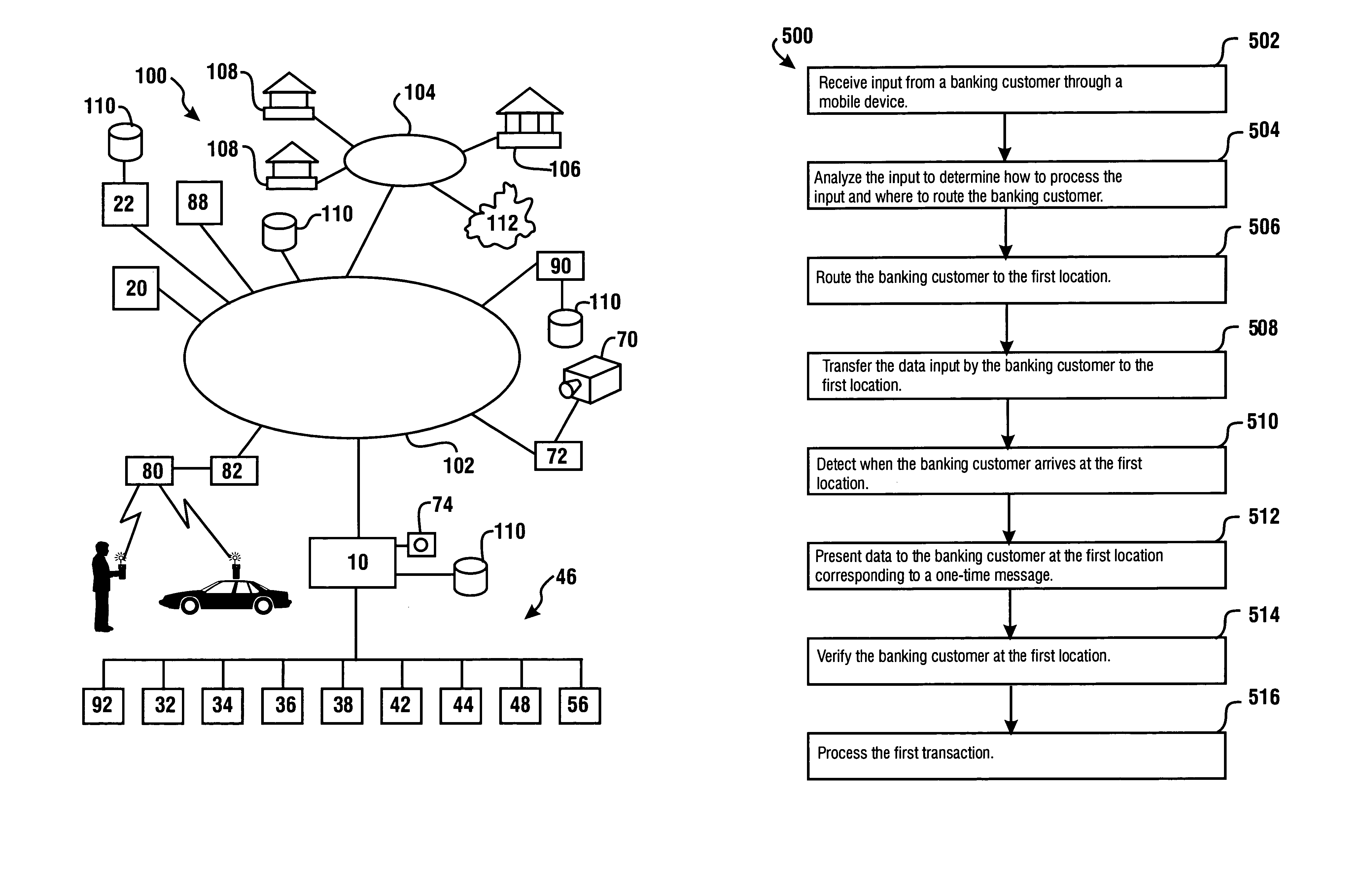

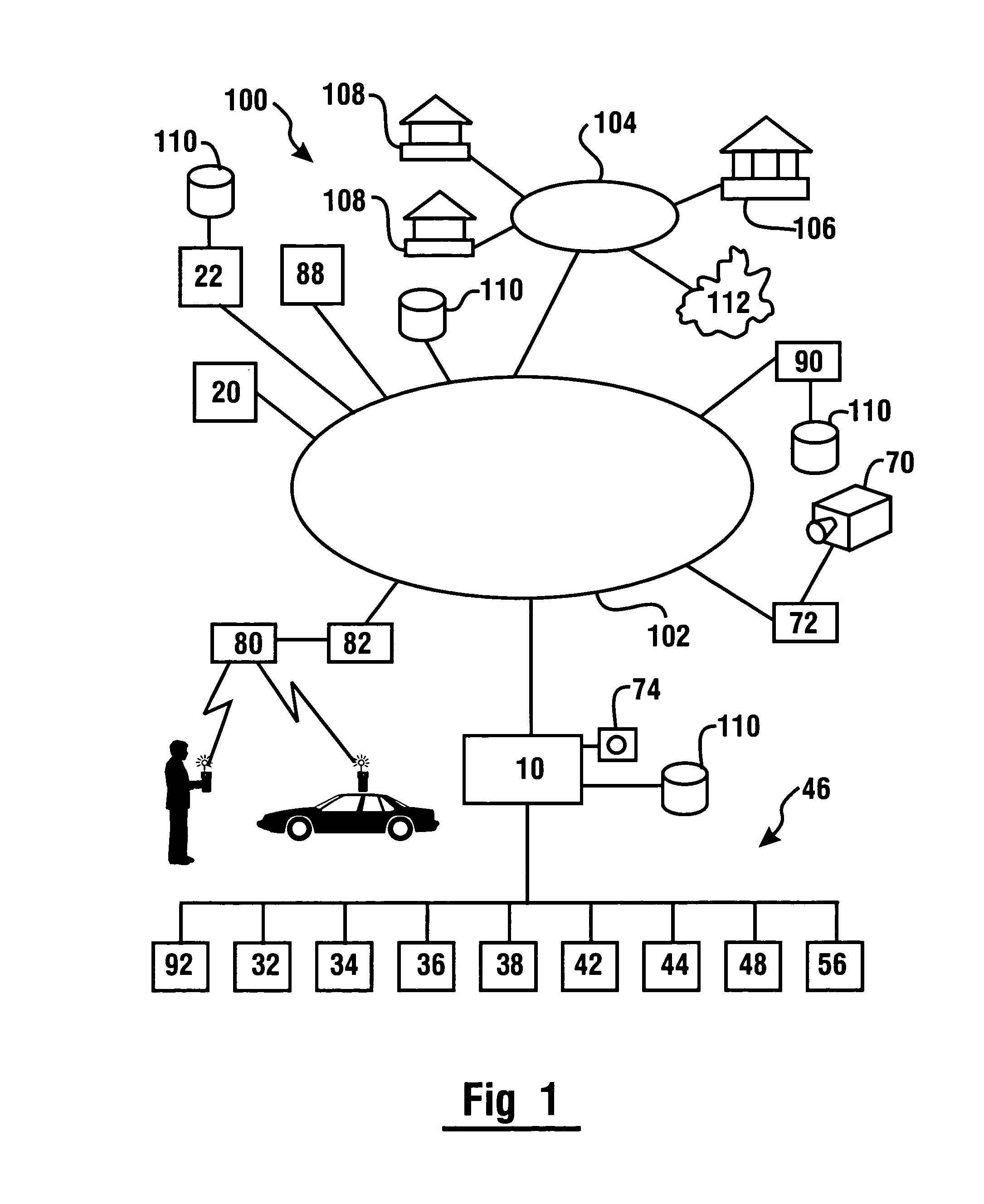

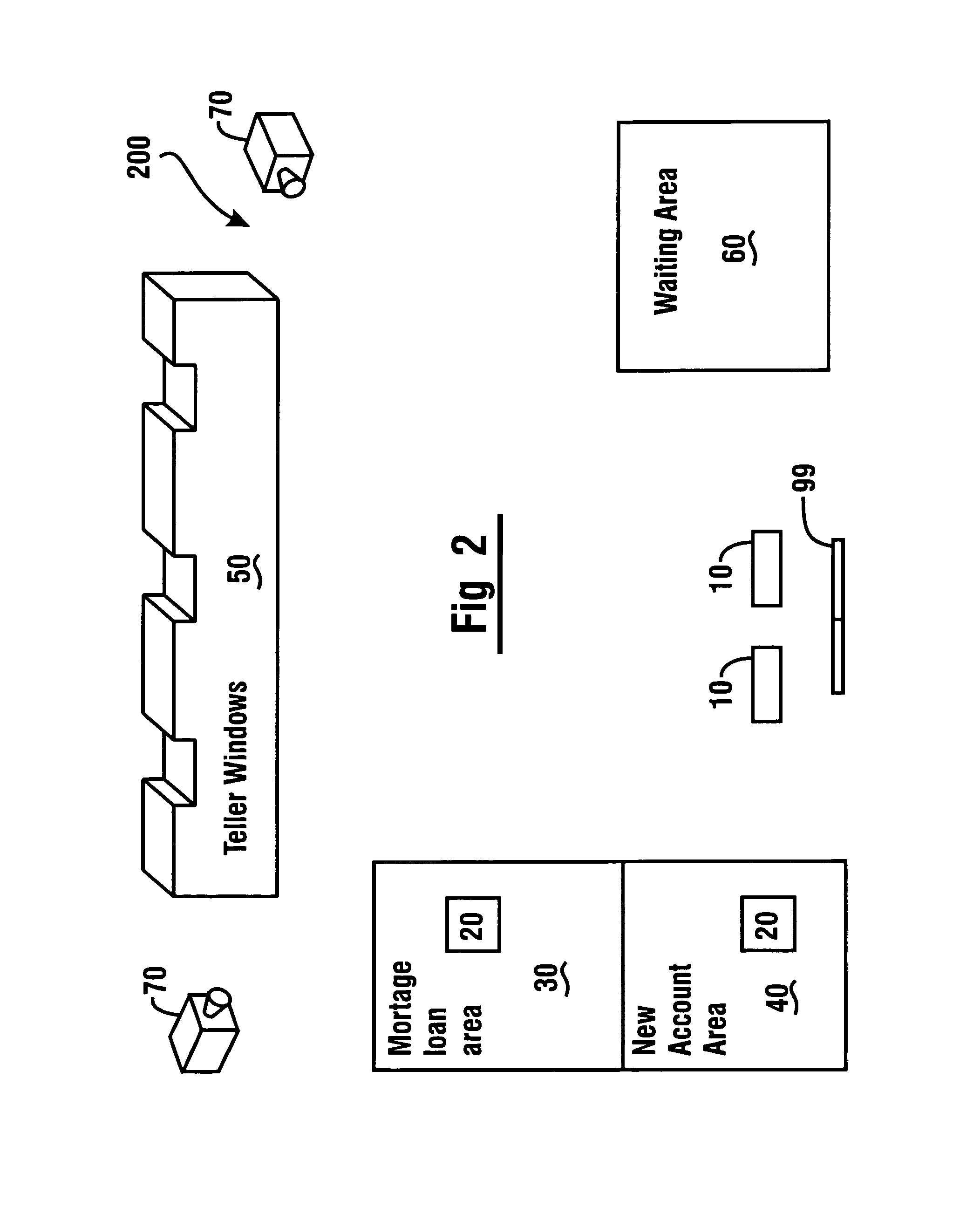

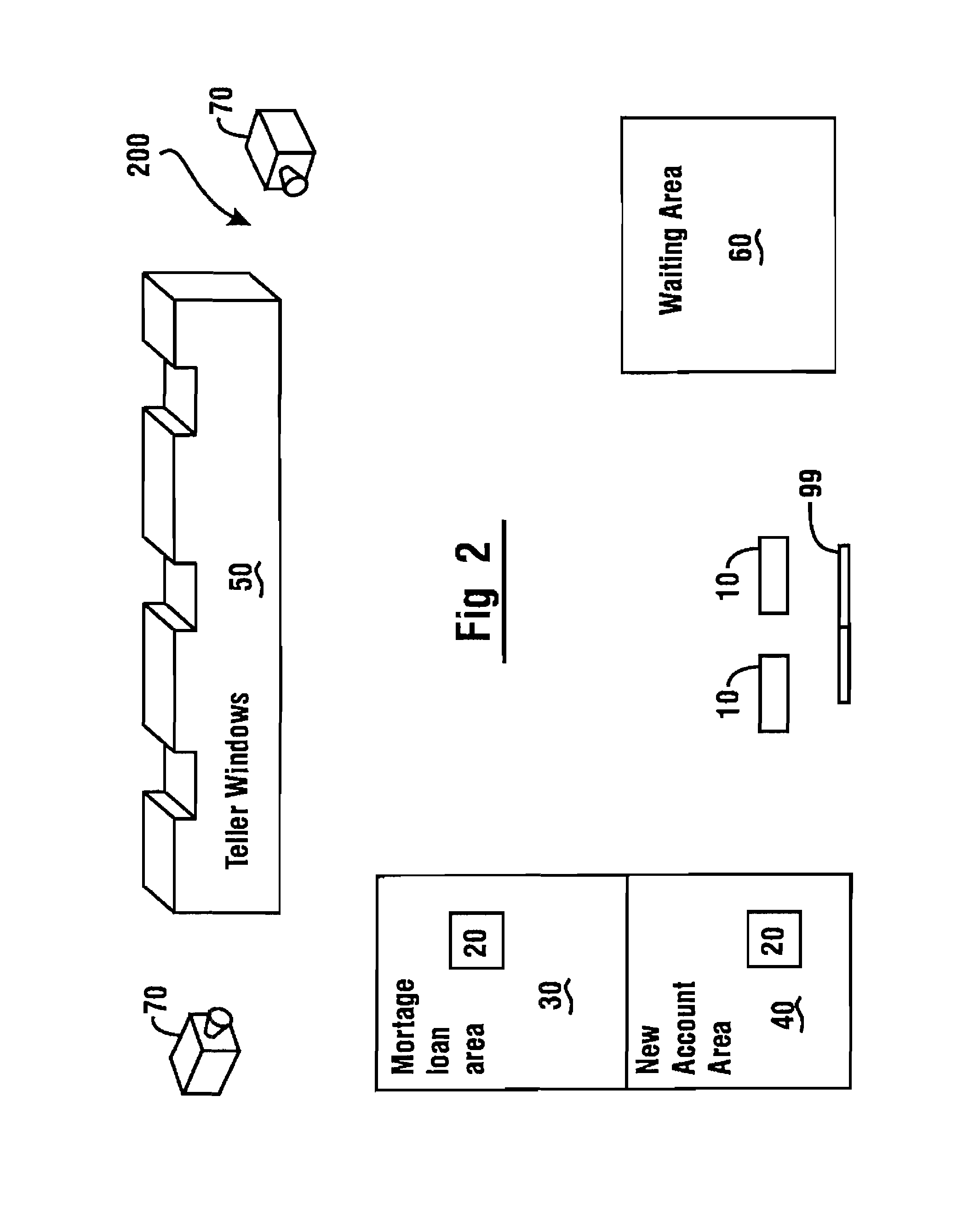

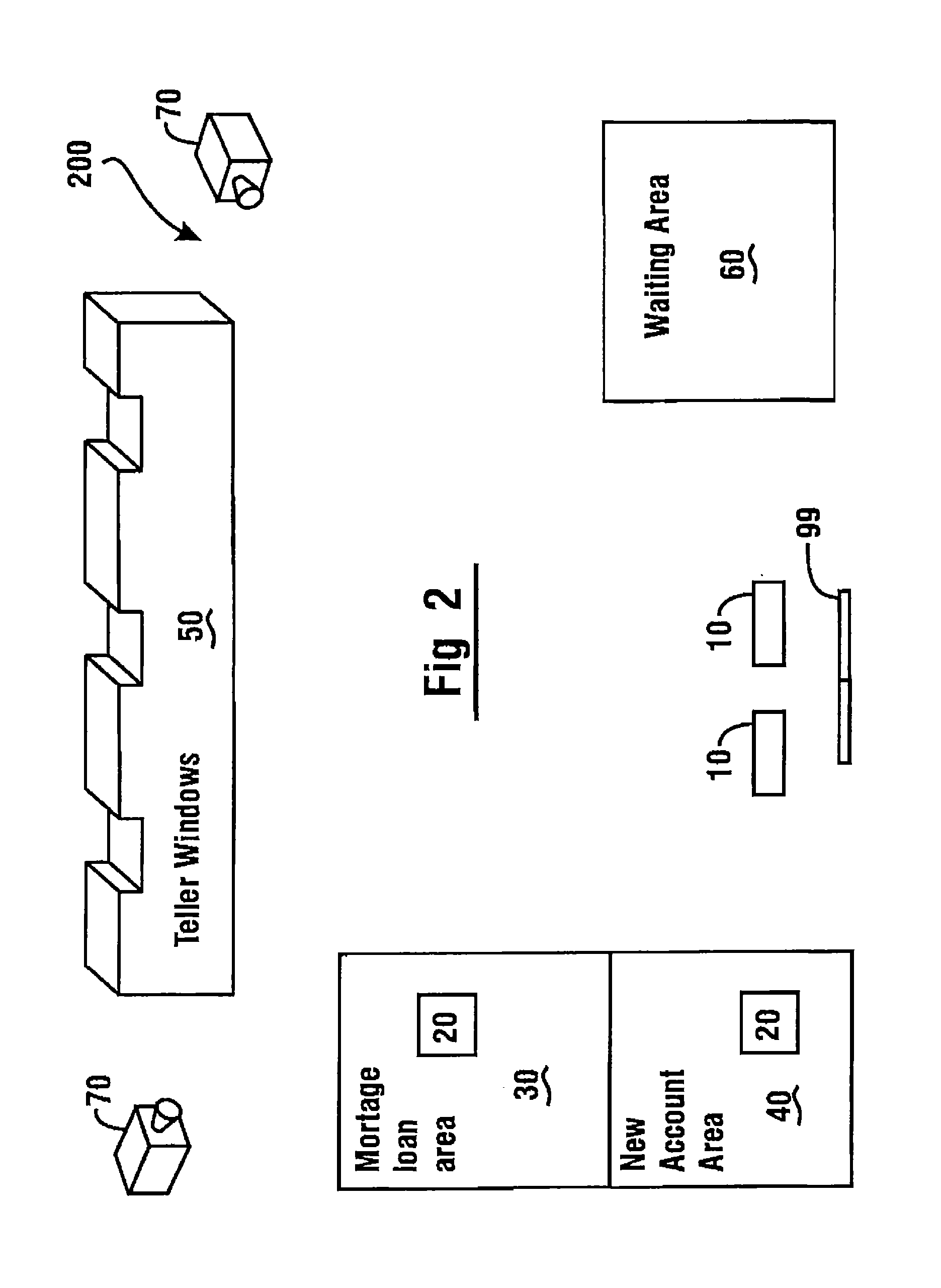

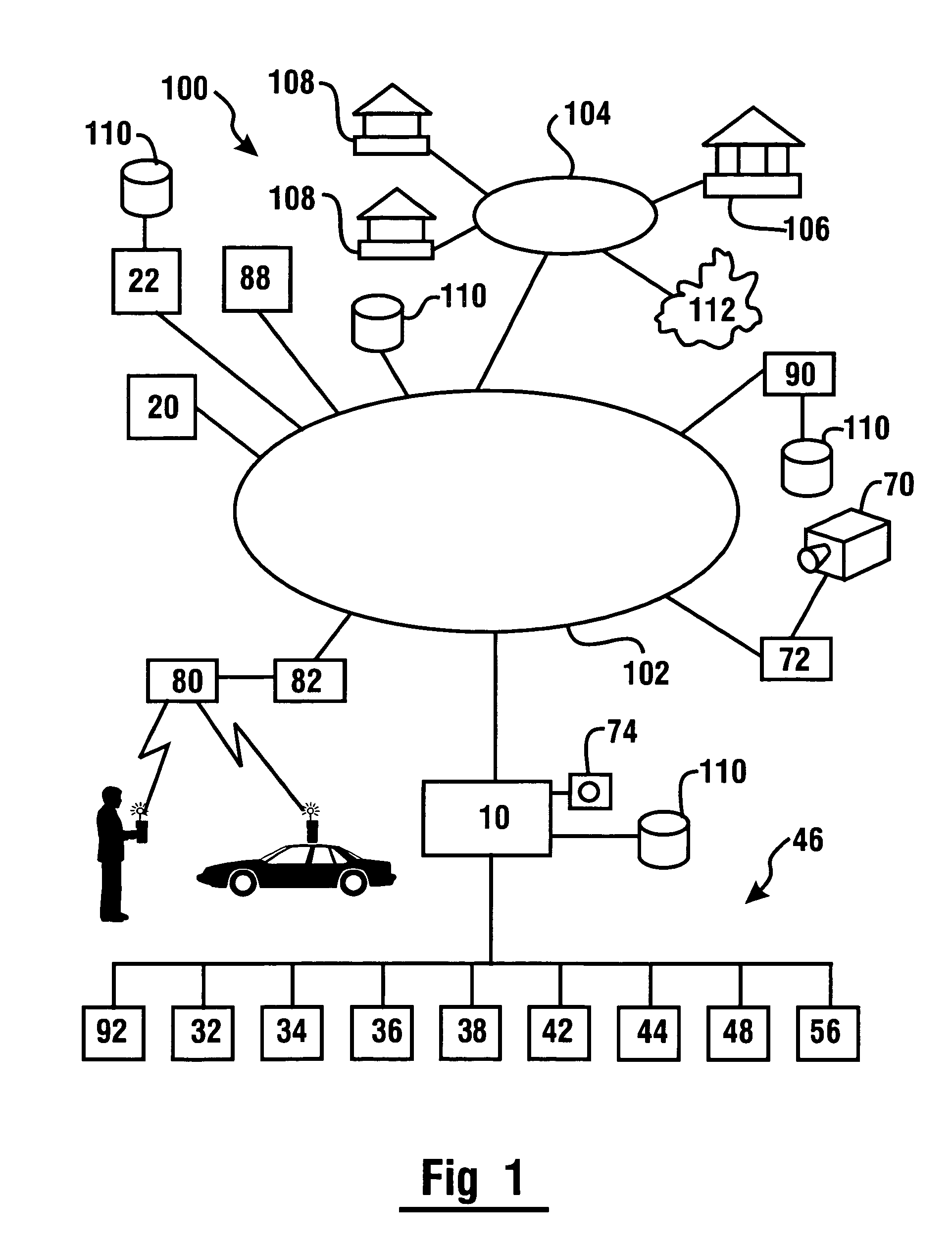

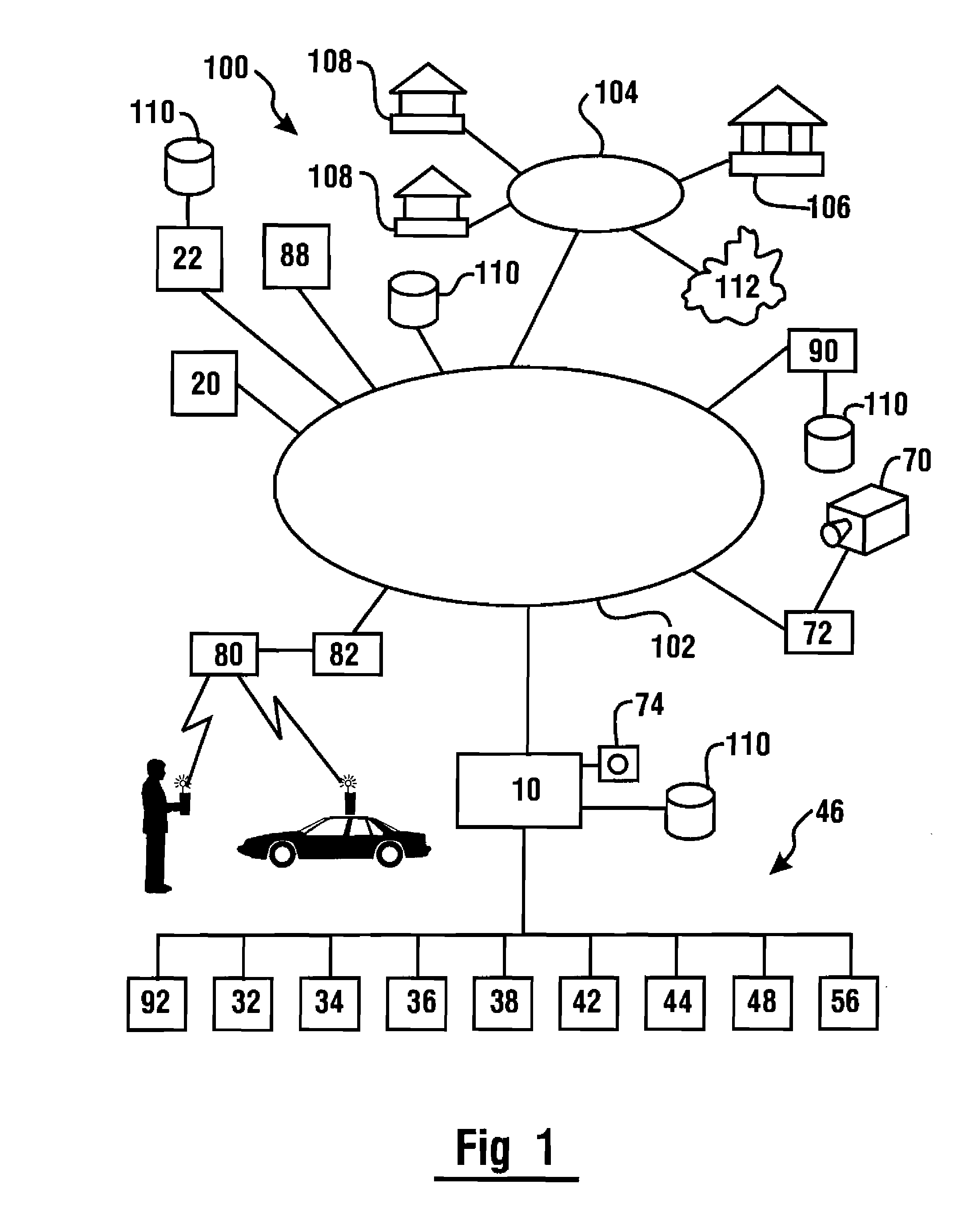

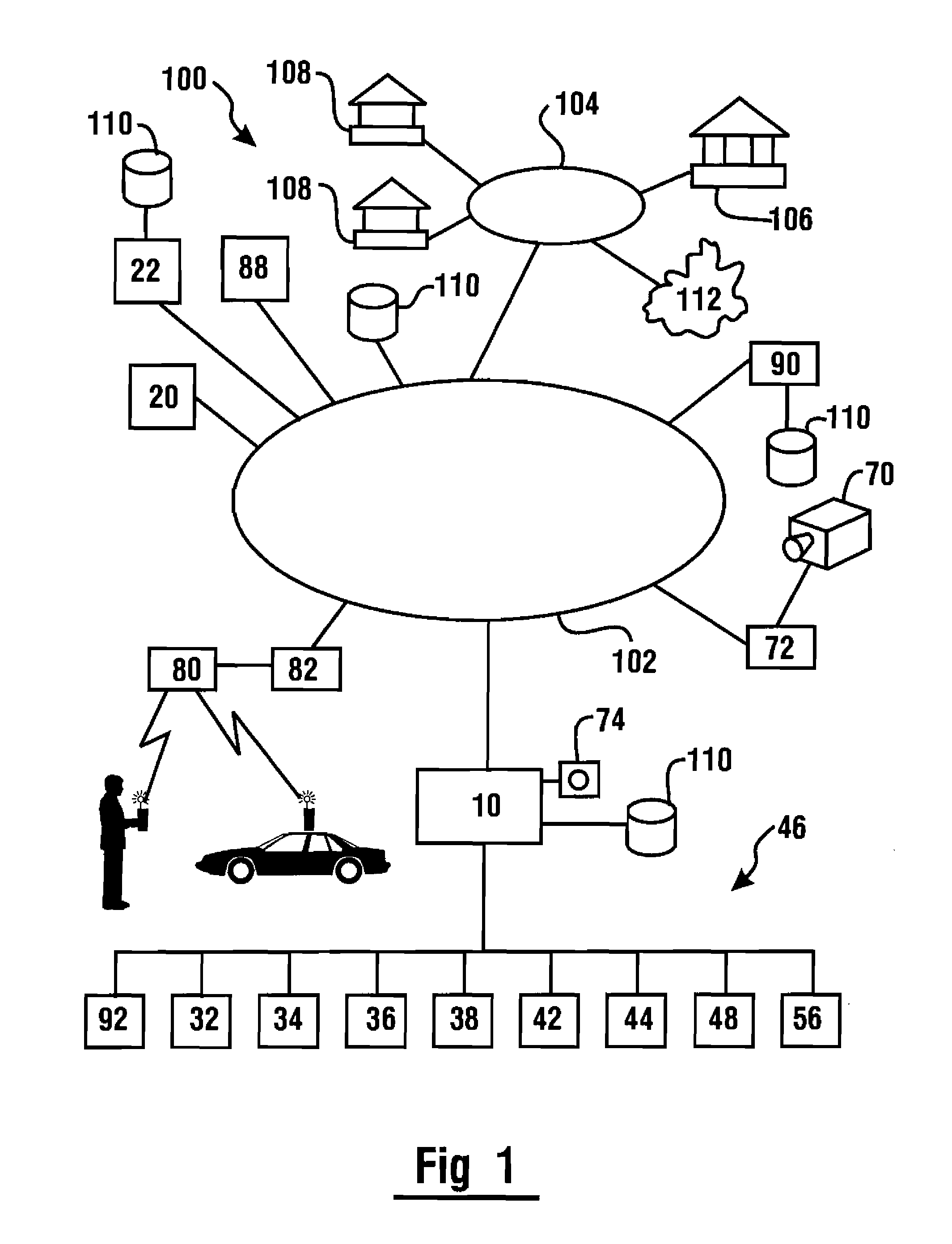

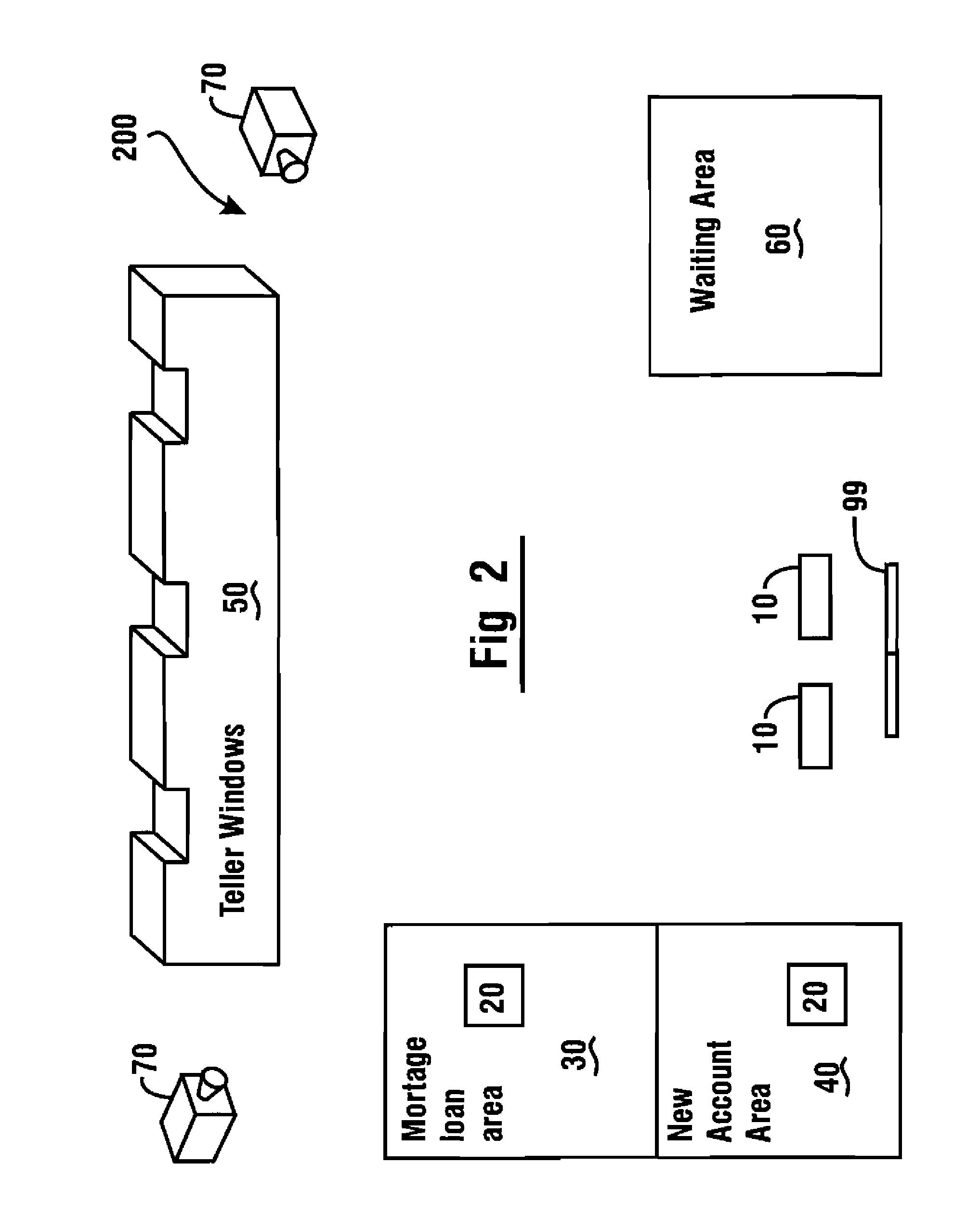

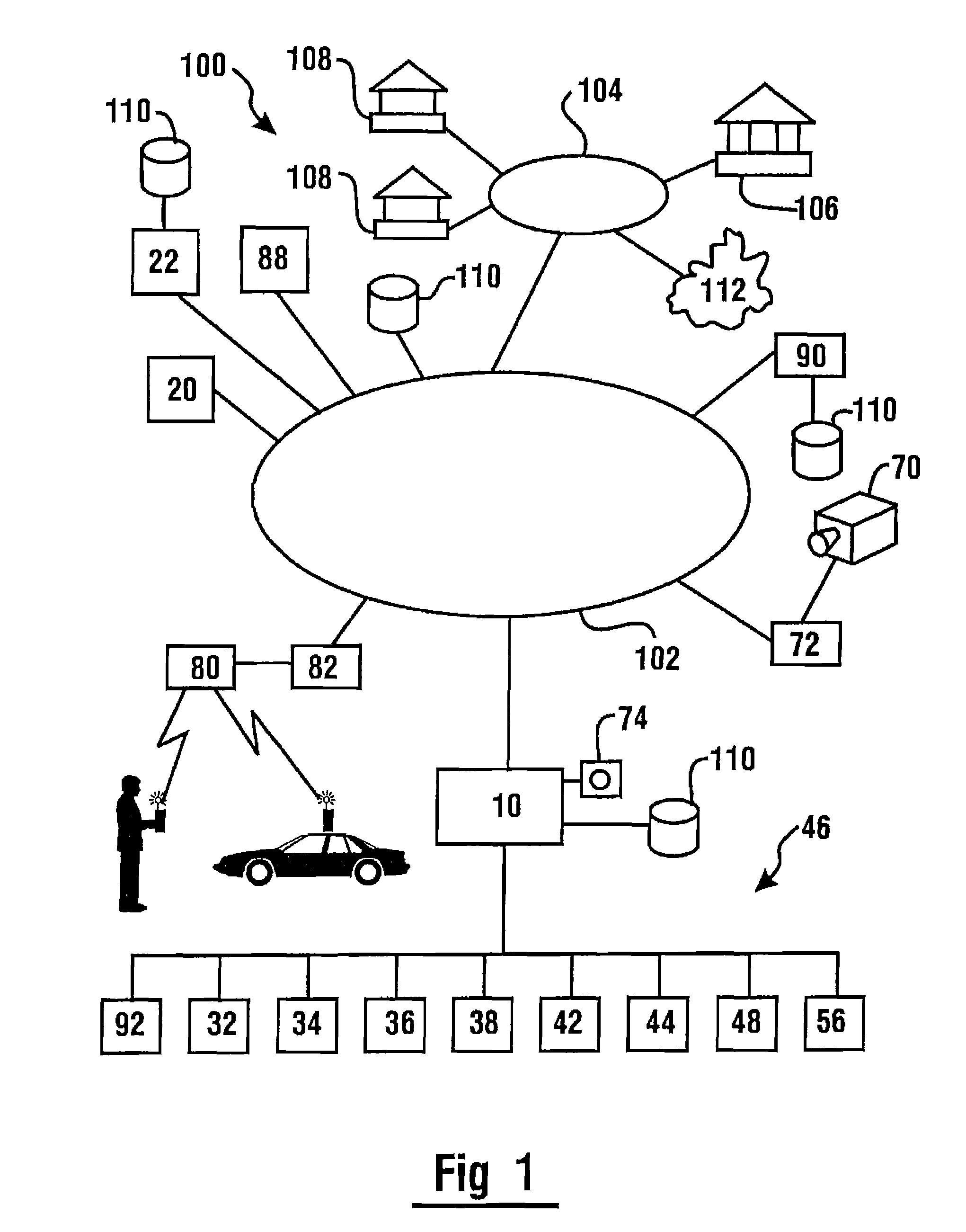

Banking system computer determines nearest bank able to process a customer's transaction request, provides directions to the bank, and sends transaction request information and customer's image to the bank before the customer arrives at the bank

ActiveUS8091778B1Accelerating transactionQuicker and shorterComplete banking machinesFinanceFinancial transactionOperating system

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

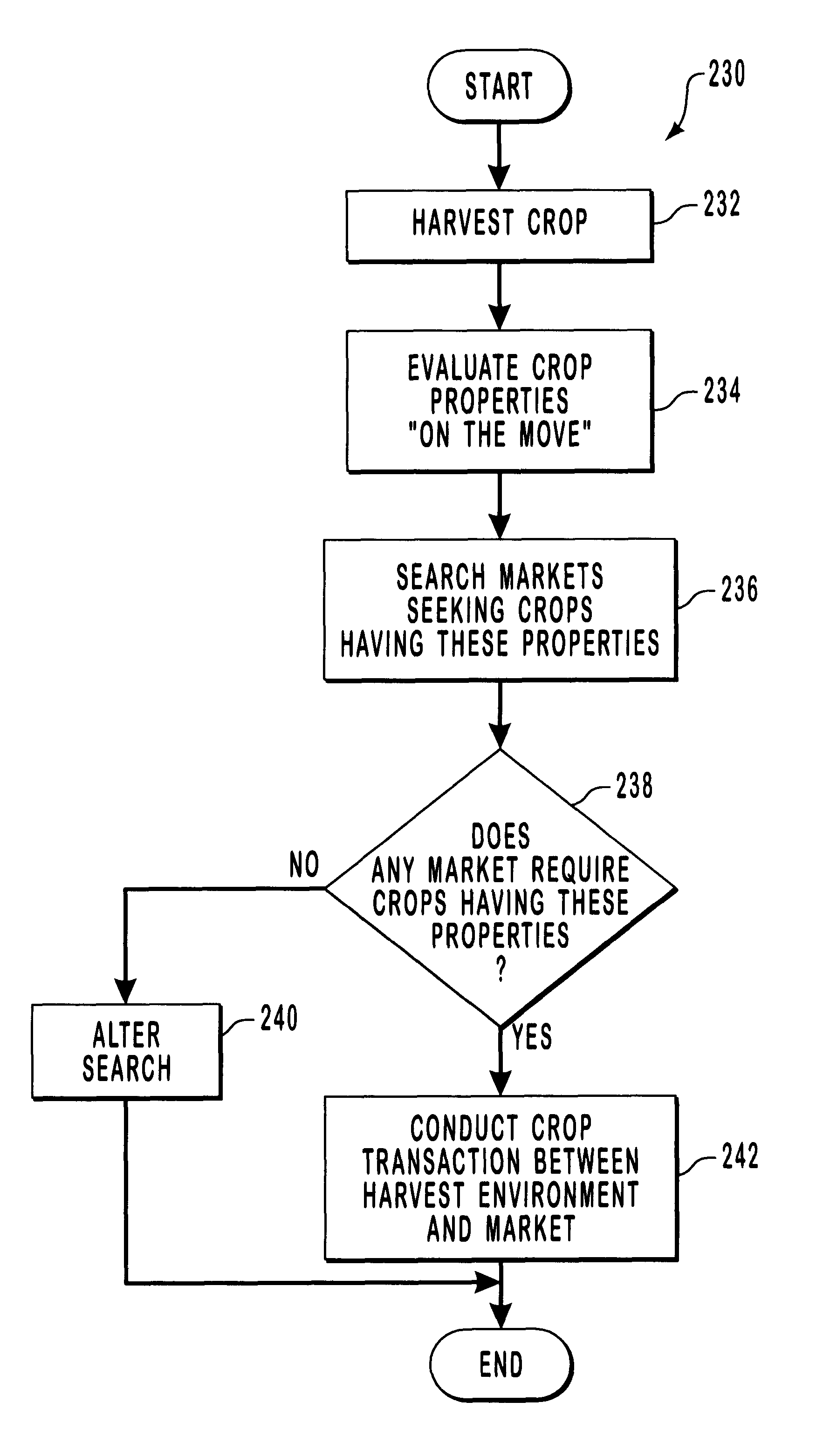

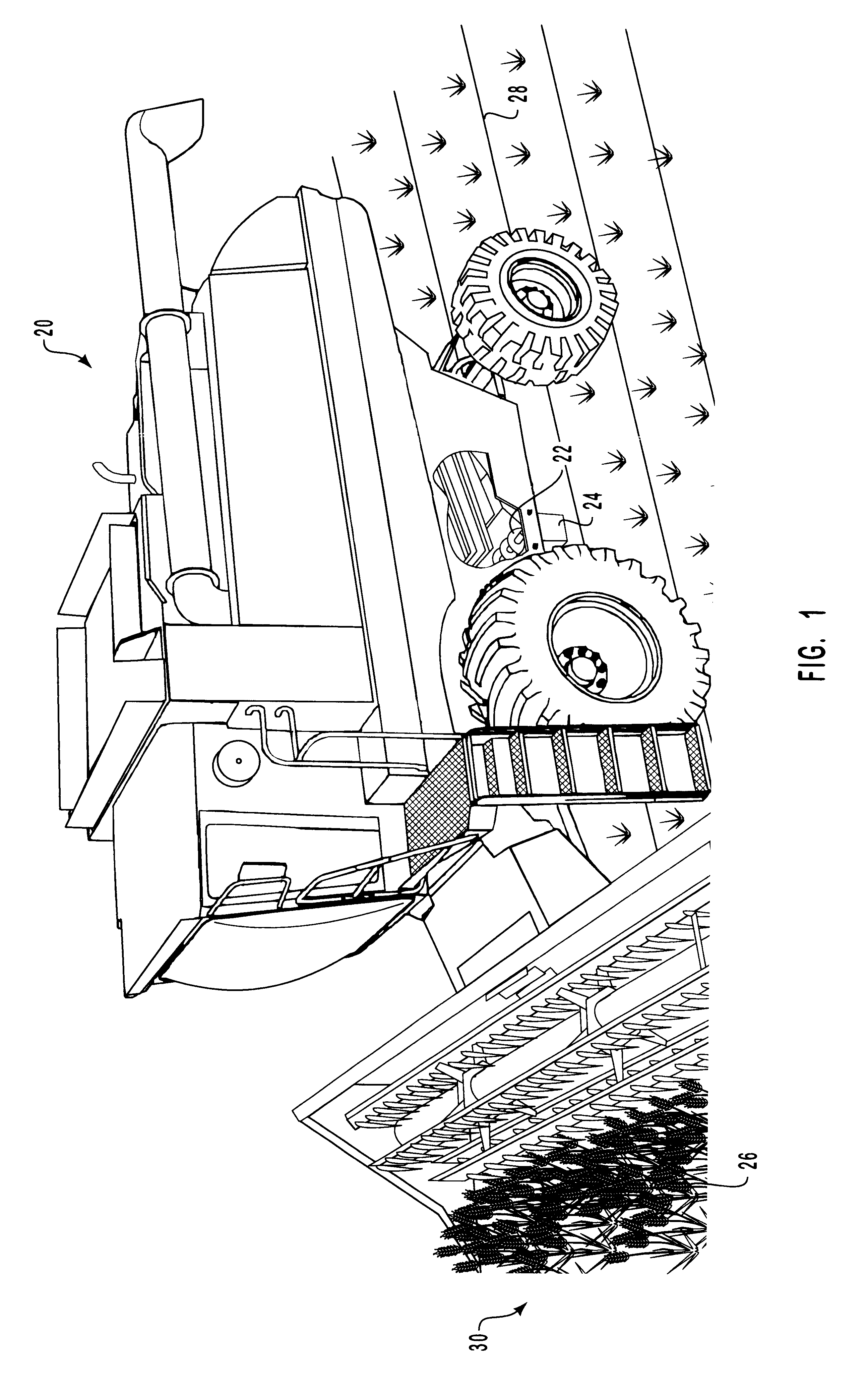

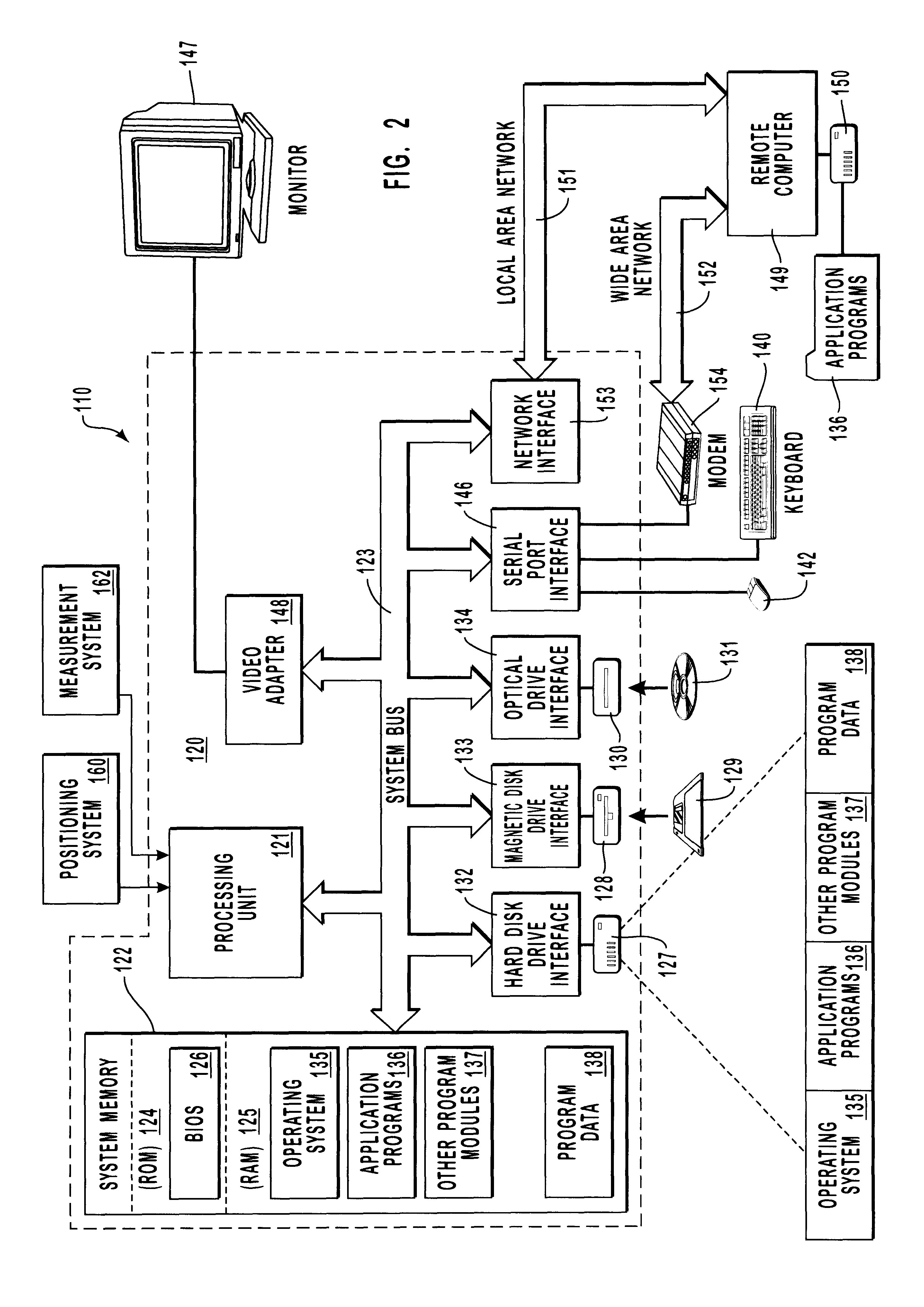

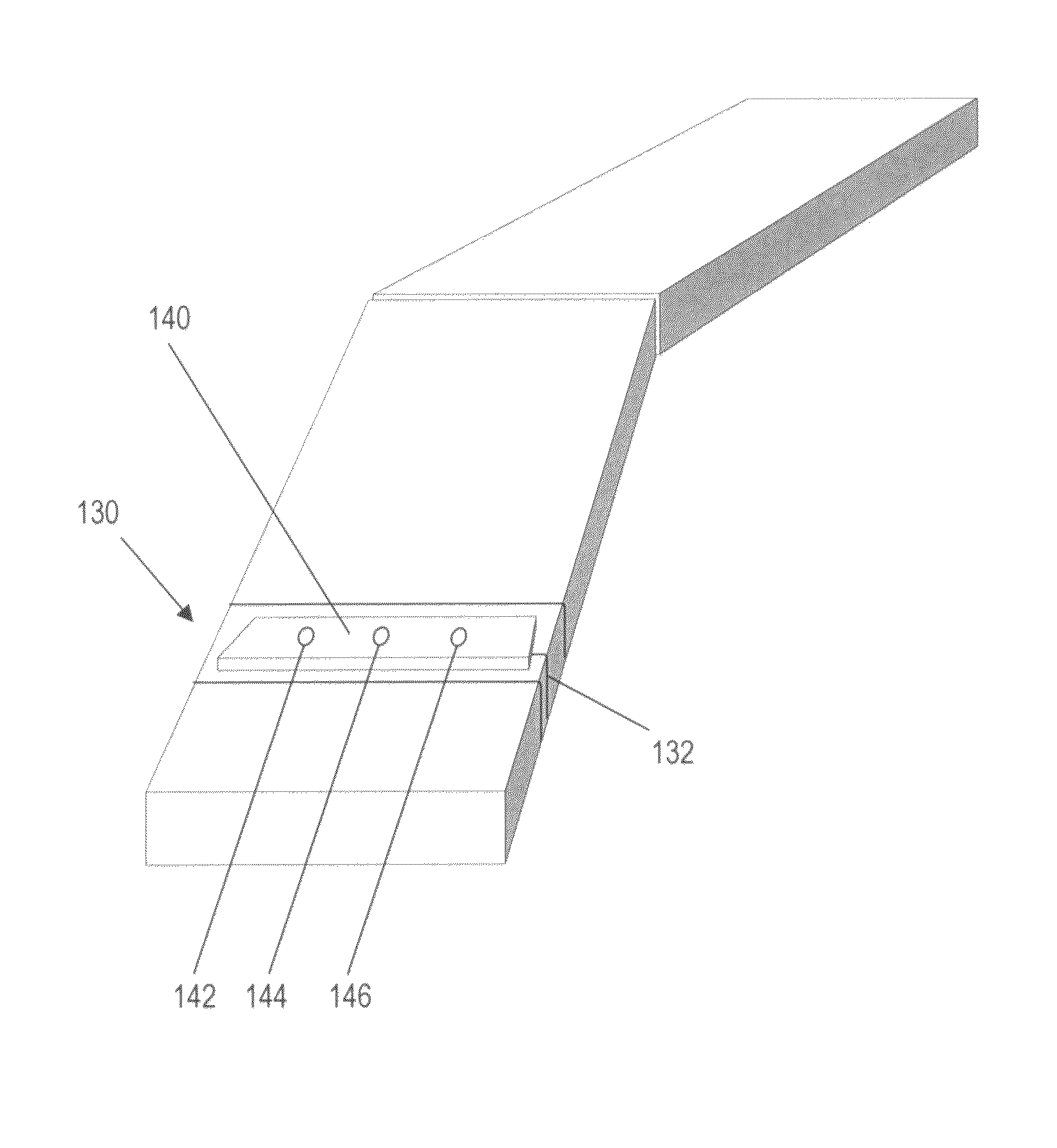

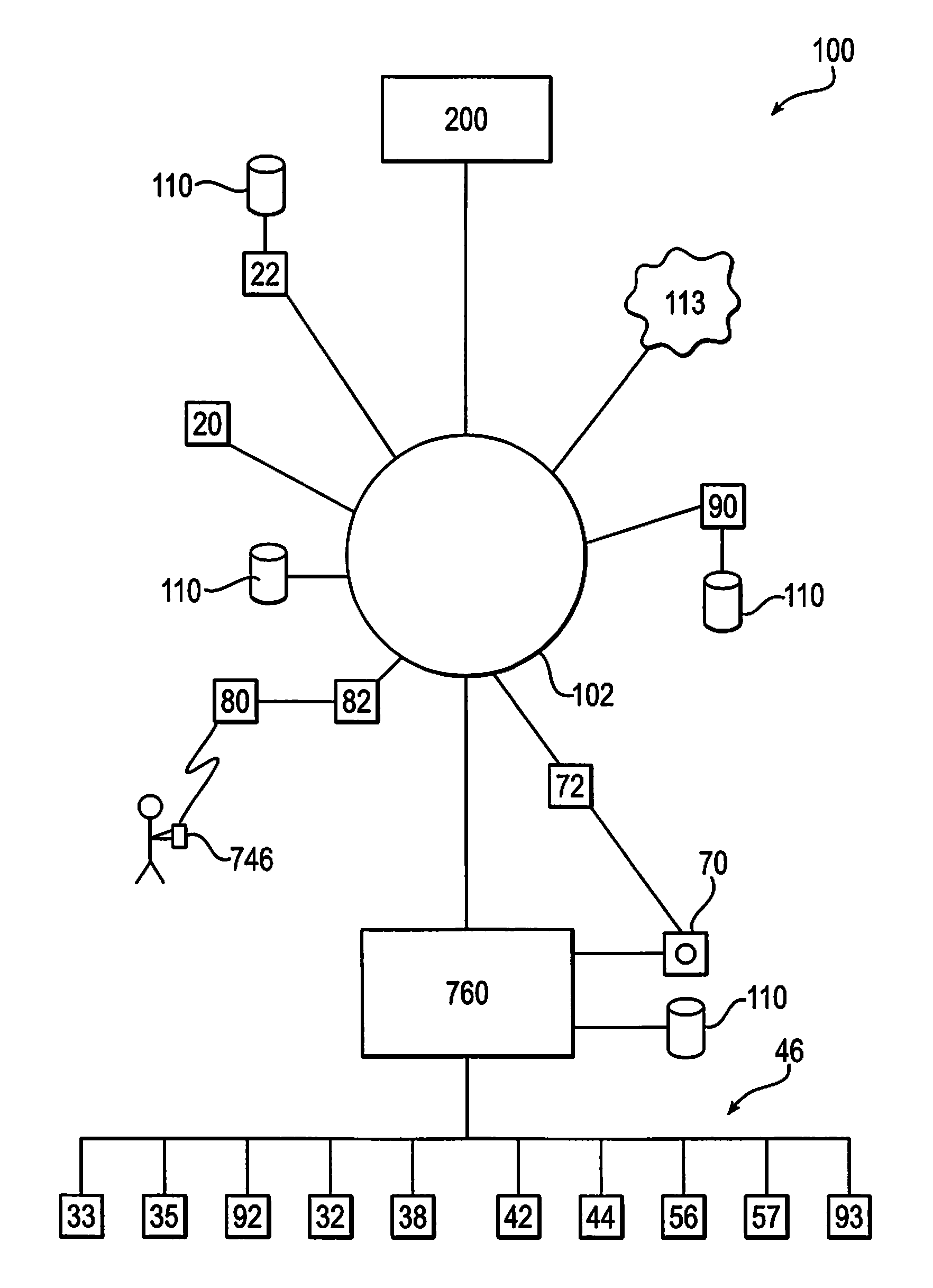

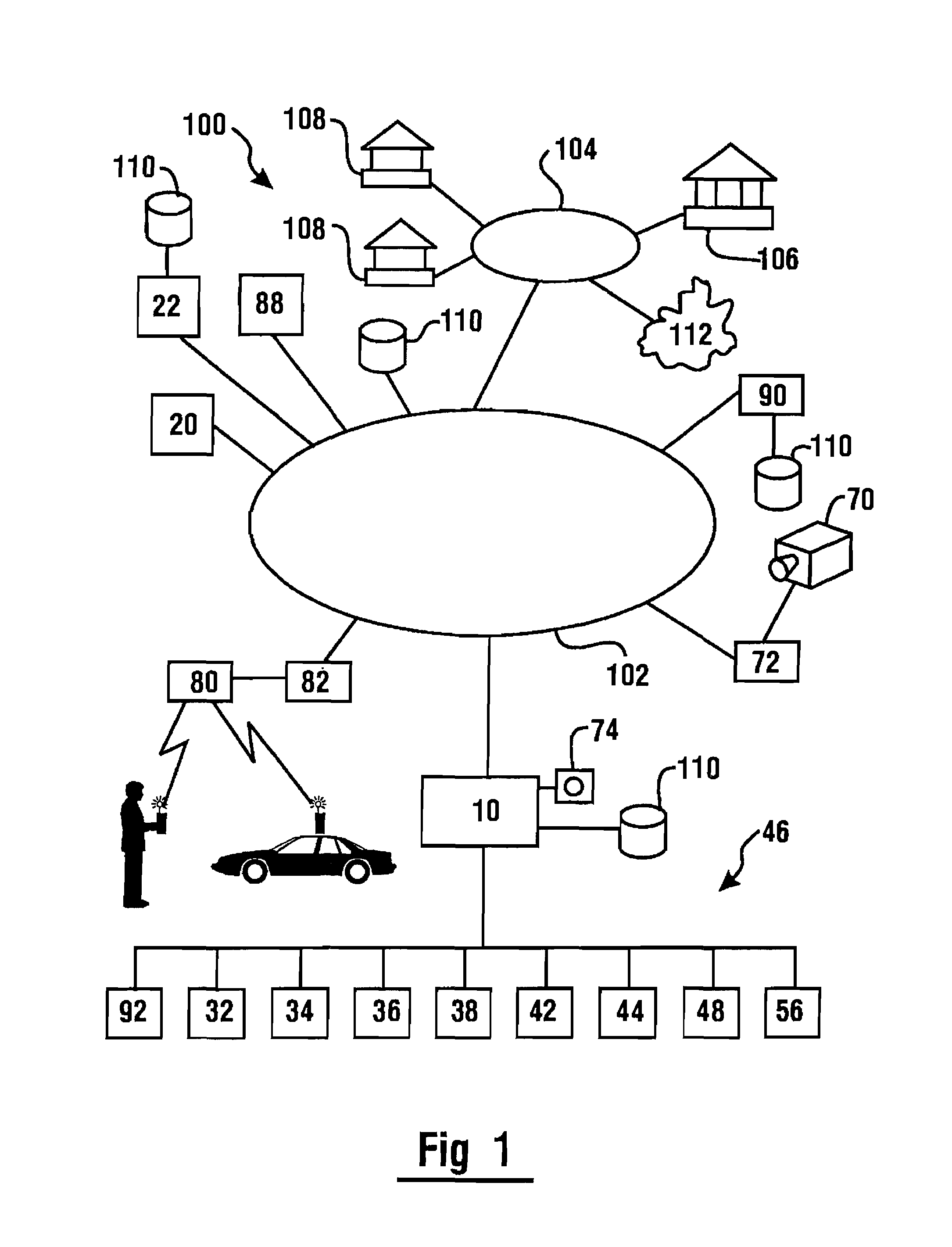

System and methods for real time linkage between harvest environment and marketplace

InactiveUS6327569B1Eliminate the problemImprovement of marketplaceFinanceClimate change adaptationTelecommunications linkEnvironment of Albania

Systems and methods are provided for directly linking a harvest environment using precision farming techniques to the marketplace. It is a feature of this invention that properties of crops are evaluated "on-the-move," during the harvest thereof, and are made known to users in the harvest environment to enable the real-time transaction for the sale of these crops. In a preferred embodiment, crops are harvested from an agricultural field in the harvest environment with a combine having an auger section thereon. A plurality of properties of the crops are evaluated on-the-move by flowing the harvested crops through the auger section and over an optical device. The optical device utilizes light reflected from the crops to determine the properties. Thereafter, the marketplace is searched with a computing configuration aboard the combine for a market seeking the crop properties. If a market is found, a wireless communication link between the harvest environment and the market is used to transact for a sale of the crops. The properties of the crops are correlated to a location in the agricultural field to expand the knowledge base about the field to enhance future precision farming operations.

Owner:MILESTONE TECH

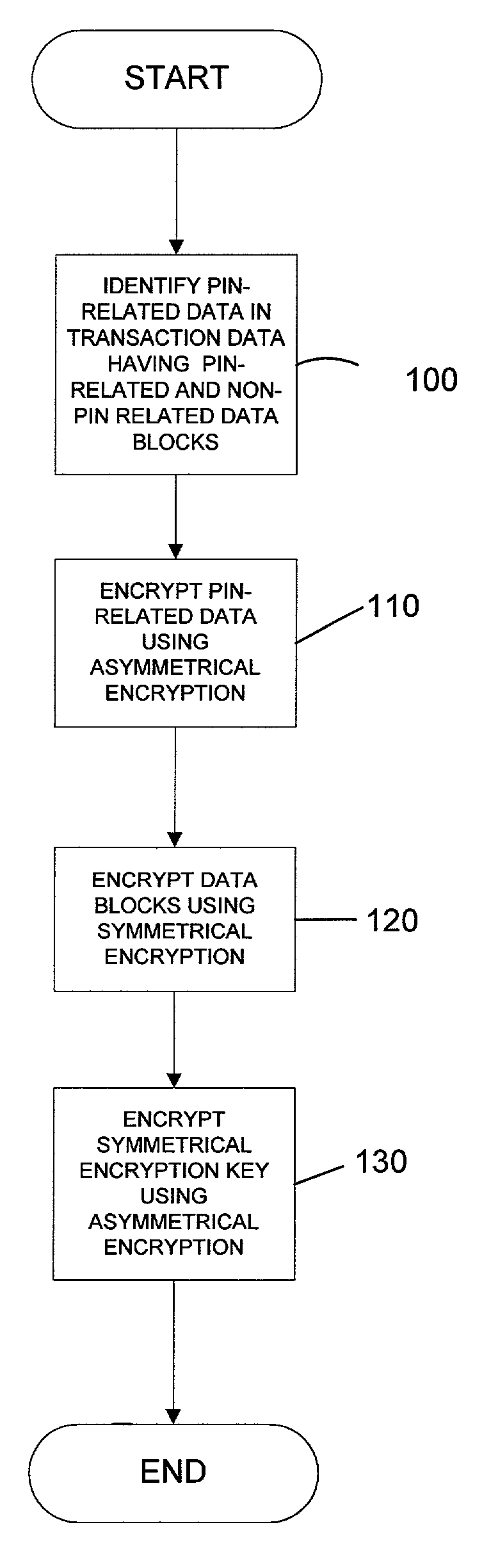

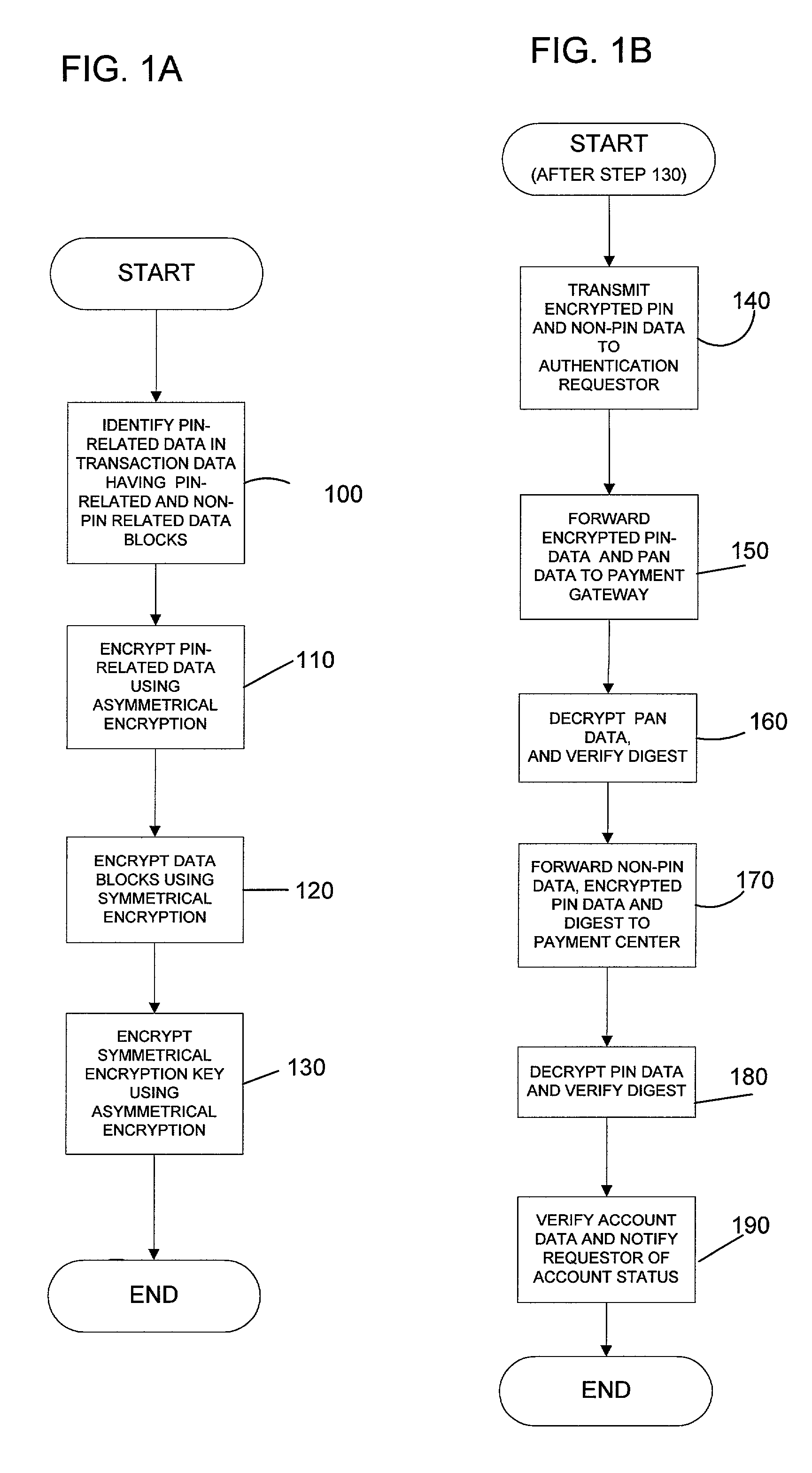

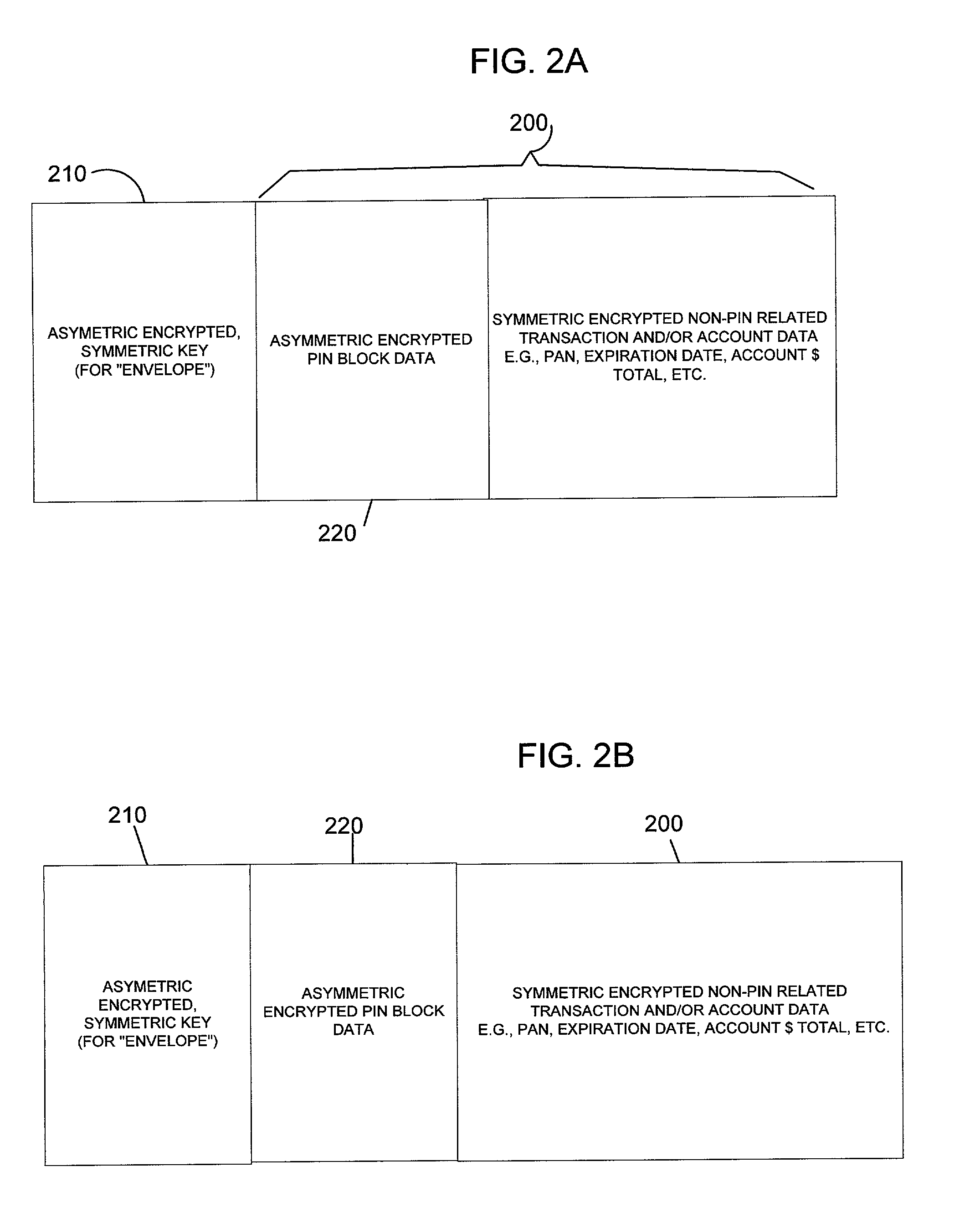

Asymmetric encrypted pin

InactiveUS7039809B1Improve securitySecure and efficientAcutation objectsDigital data processing detailsPersonal identification numberEncryption

Secure protection and distribution of a personal identification number (PIN) is achieved by using a first encryption process only for PIN data and a second encryption process for non-PIN data. The first encryption process uses asymmetric encryption, where a public key is used for encryption of PIN data and a private key, held only by an authorizing agent, is used to decrypt the PIN data. The second encryption process uses a key which is available to an authentication requestor, such as merchants. A party seeking authentication of PIN data must forward the encrypted PIN data to an authorizing agent along with account data necessary to validate the PIN data. The authentication requestor is provided with a signal which is indicative of the verification status of the PIN data without being privy to the contents of the PIN data.

Owner:MASTERCARD INT INC

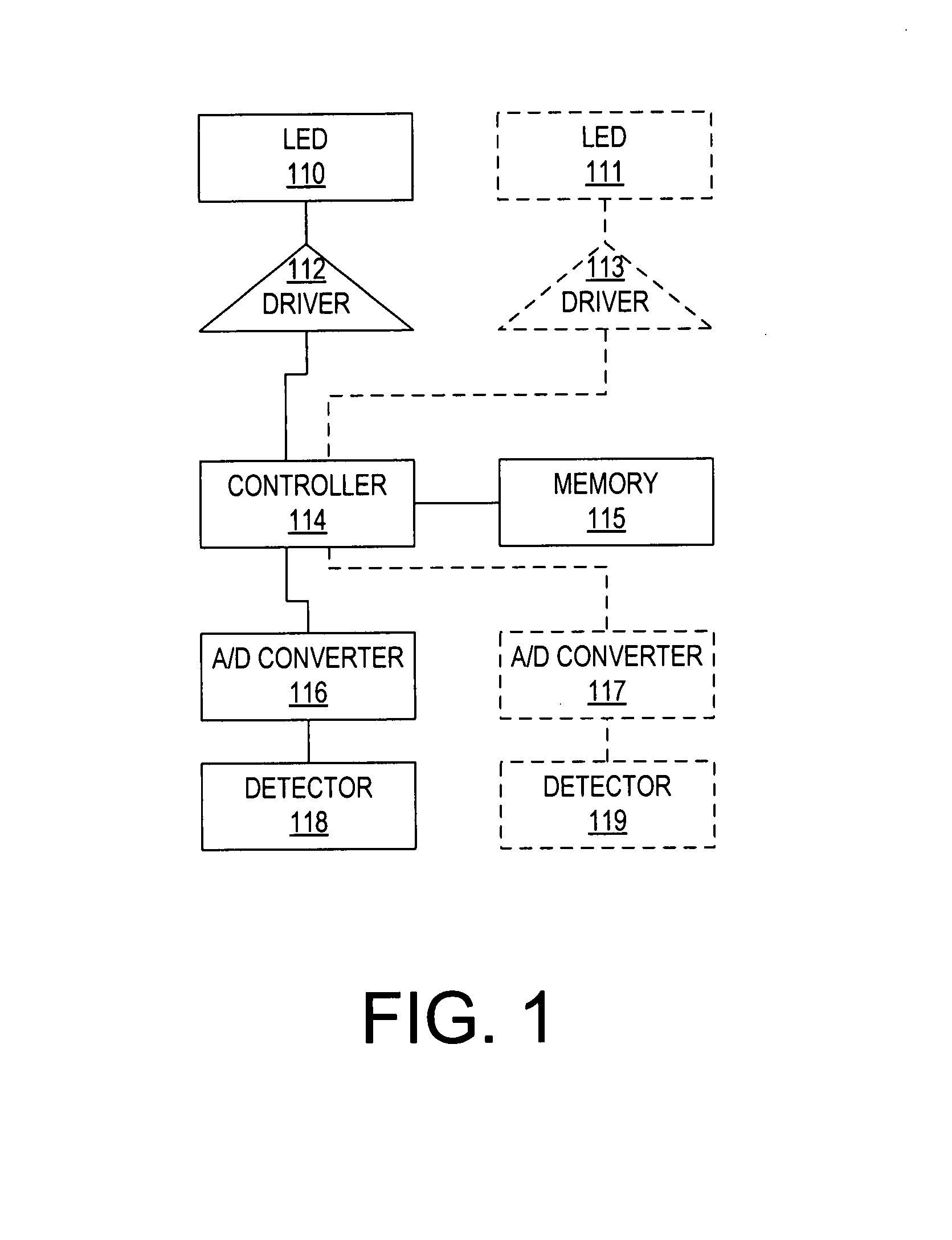

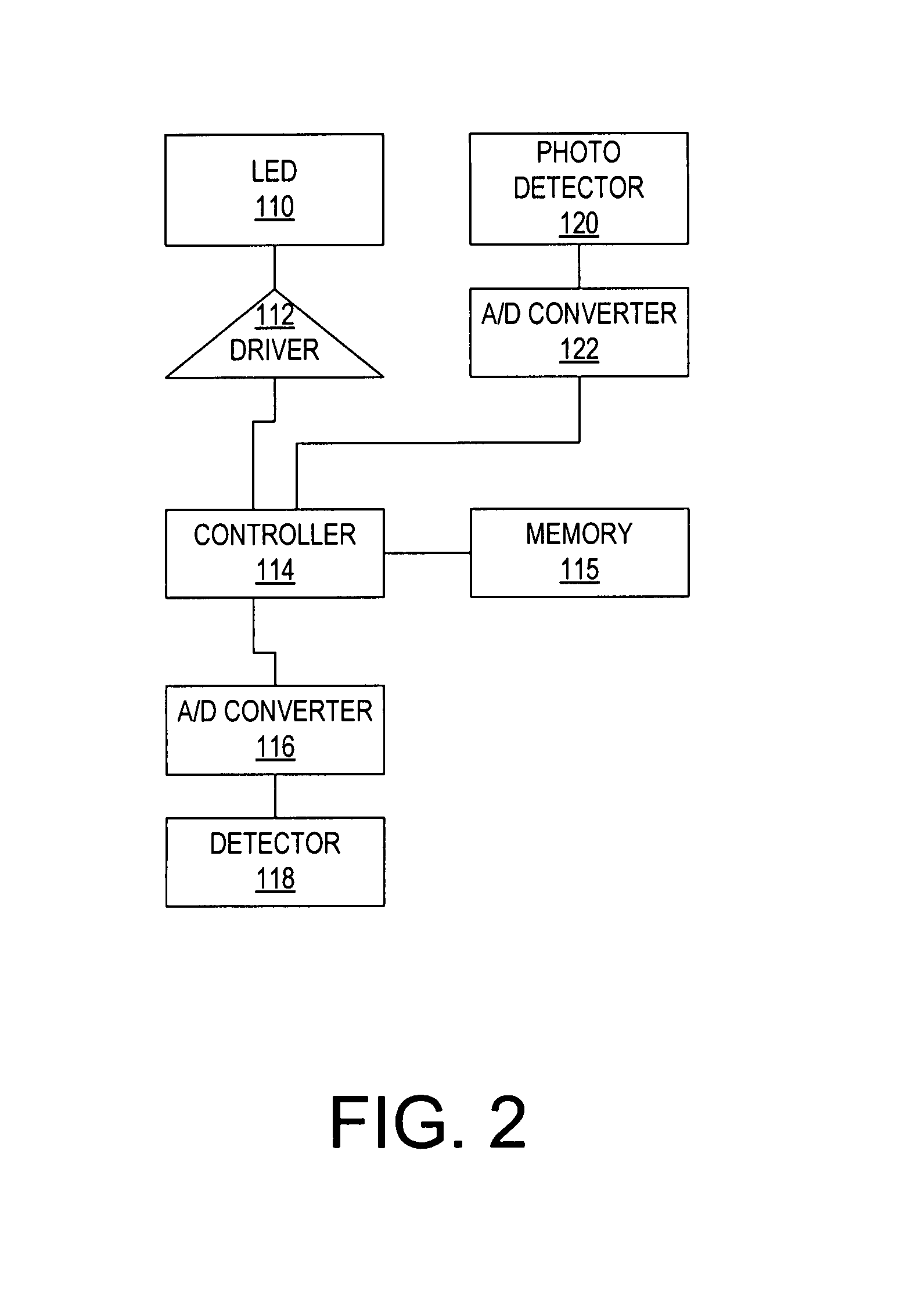

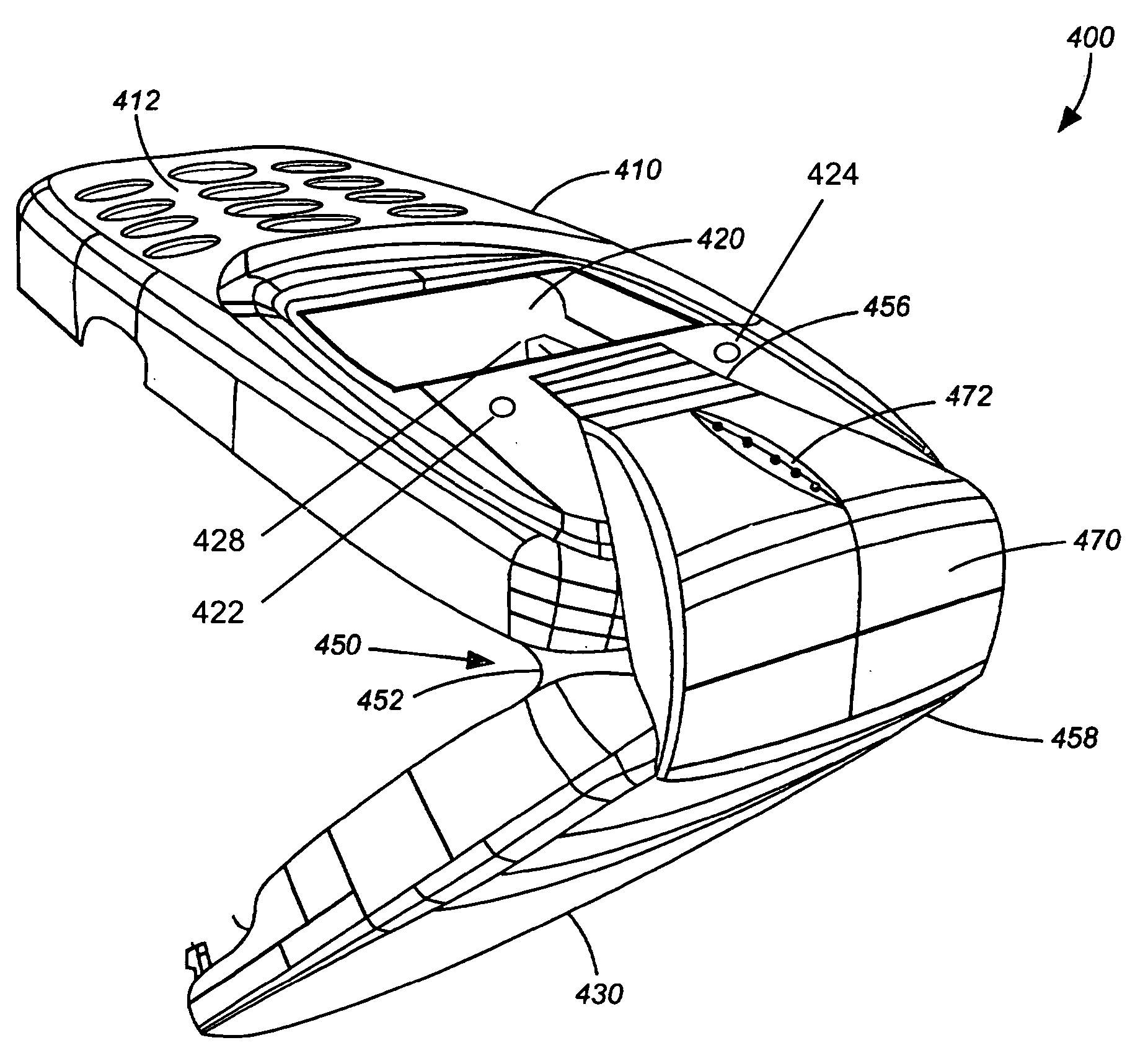

System, method and apparatus for communicating information from a personal electronic device

ActiveUS7857225B2Easy to useAccelerating transactionMemory record carrier reading problemsCharacter and pattern recognitionRadio frequency energyBarcode

An accessory for a personal electronic device detects data encoded into light, sound, vibration energy, radio frequency energy, or a combination thereof, and provides the encoded data either to a bar code scanner using light, or to an NFC terminal using NFC protocols. The accessory may be stand-alone, or attachable to the personal electronic device from a suitable housing or integrated into a housing component of the personal electronic device.

Owner:SAMSUNG ELECTRONICS CO LTD

Transaction accelerator for client-server communication systems

InactiveUS20060069719A1Less bandwidth usedAccelerating transactionMemory adressing/allocation/relocationIndividual digits conversionClient-sideServer-side

In a network having transaction acceleration, for an accelerated transaction, a client directs a request to a client-side transaction handler that forwards the request to a server-side transaction handler, which in turn provides the request, or a representation thereof, to a server for responding to the request. The server sends the response to the server-side transaction handler, which forwards the response to the client-side transaction handler, which in turn provides the response to the client. Transactions are accelerated by the transaction handlers by storing segments of data used in the transactions in persistent segment storage accessible to the server-side transaction handler and in persistent segment storage accessible to the client-side transaction handler. When data is to be sent between the transaction handlers, the sending transaction handler compares the segments of the data to be sent with segments stored in its persistent segment storage and replaces segments of data with references to entries in its persistent segment storage that match or closely match the segments of data to be replaced. The receiving transaction store reconstructs the data sent by replacing segment references with corresponding segment data from its persistent segment storage, requesting missing segments from the sender as needed. The transaction accelerators could handle multiple clients and / or multiple servers and the segments stored in the persistent segment stores can relate to different transactions, different clients and / or different servers. Persistent segment stores can be prepopulated with segment data from other transaction accelerators.

Owner:RIVERBED TECH LLC

System, method and apparatus for communicating information from a personal electronic device

ActiveUS20080128505A1Easy to useAccelerating transactionMemory record carrier reading problemsVisual presentationRadio frequency energyBarcode

An accessory for a personal electronic device detects data encoded into light, sound, vibration energy, radio frequency energy, or a combination thereof, and provides the encoded data either to a bar code scanner using light, or to an NFC terminal using NFC protocols. The accessory may be stand-alone, or attachable to the personal electronic device from a suitable housing or integrated into a housing component of the personal electronic device.

Owner:SAMSUNG ELECTRONICS CO LTD

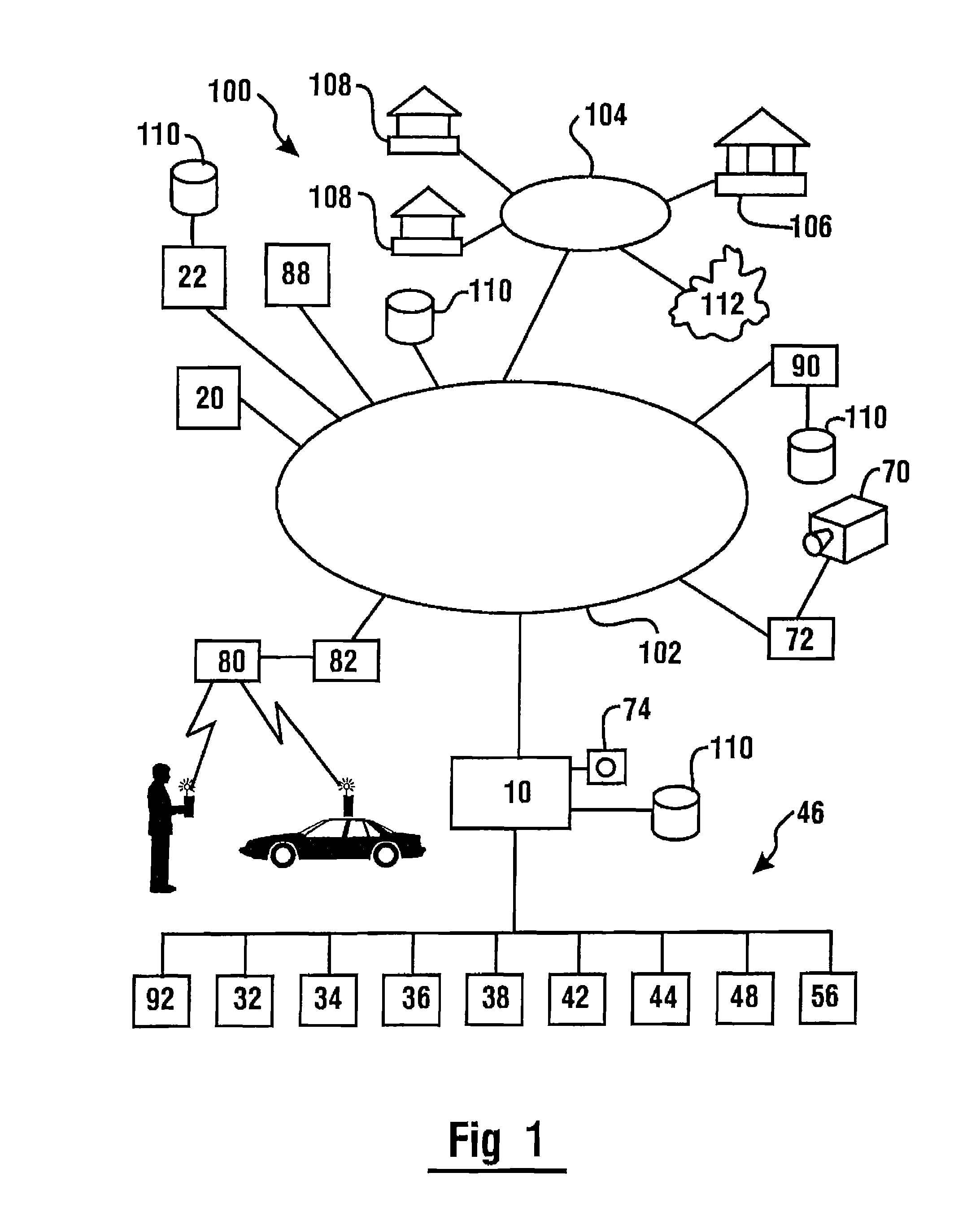

Check cashing automated banking machine

An automated banking machine is operated at least in part to data read from data bearing records. The machine is operative to carry out a financial transfer responsive at least in part to a determination that data read through a card reader of the machine corresponds to a financial account that is authorized to conduct a transaction through operation of the machine. The machine also includes a check acceptor operative to receive checks from machine users. The check acceptor is operative image checks and data resolved from check images is used in operation of the machine to cause financial transfers.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

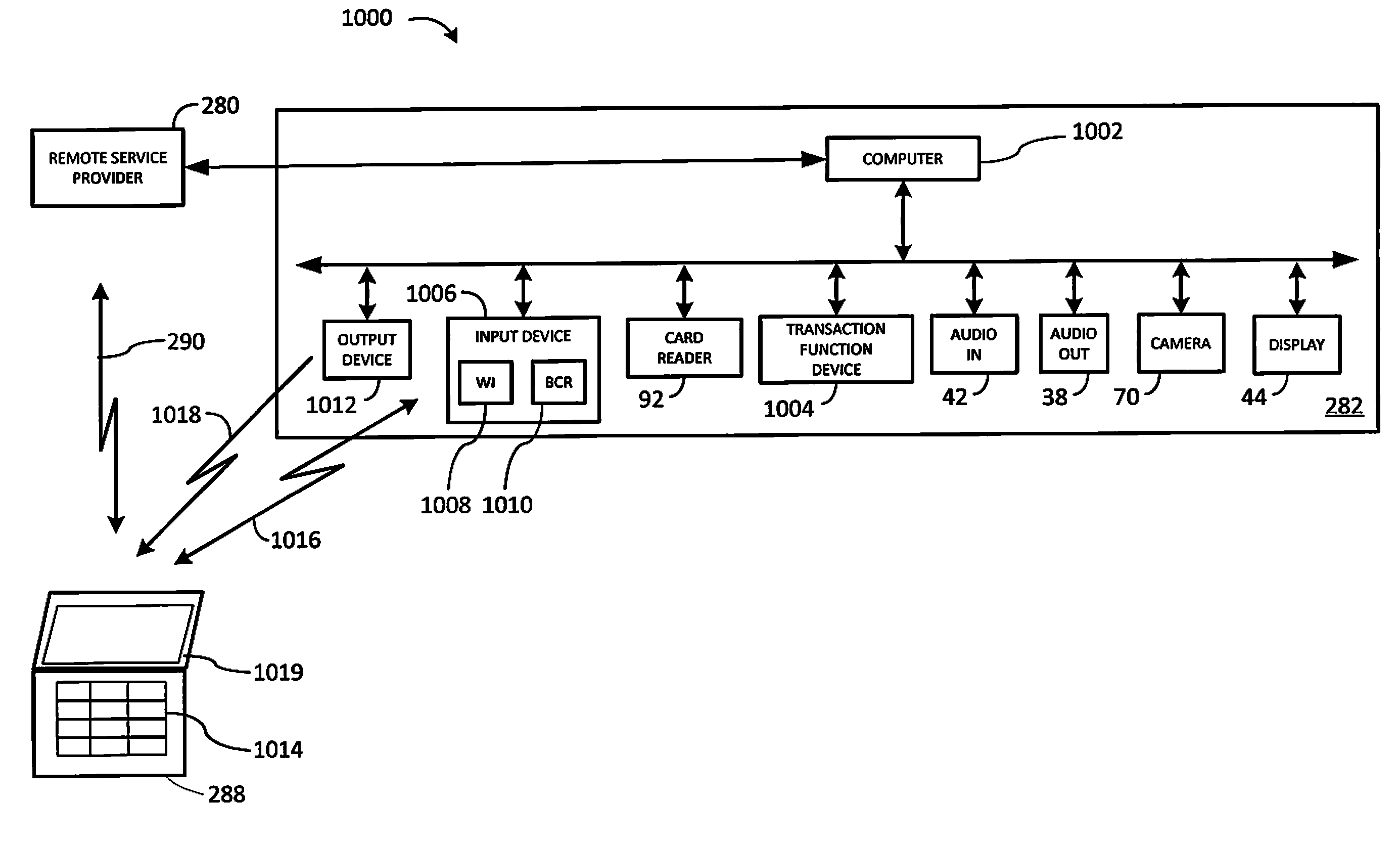

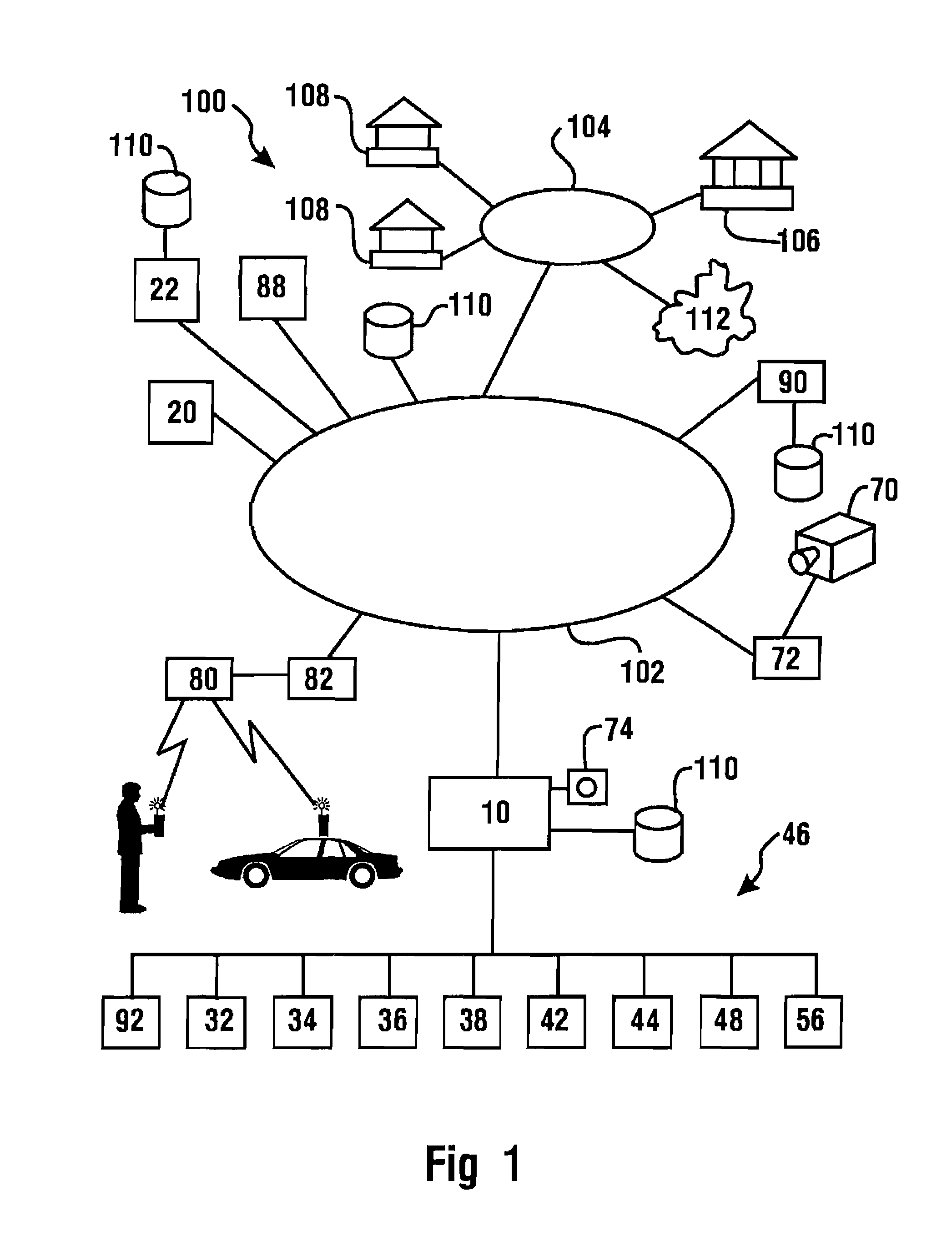

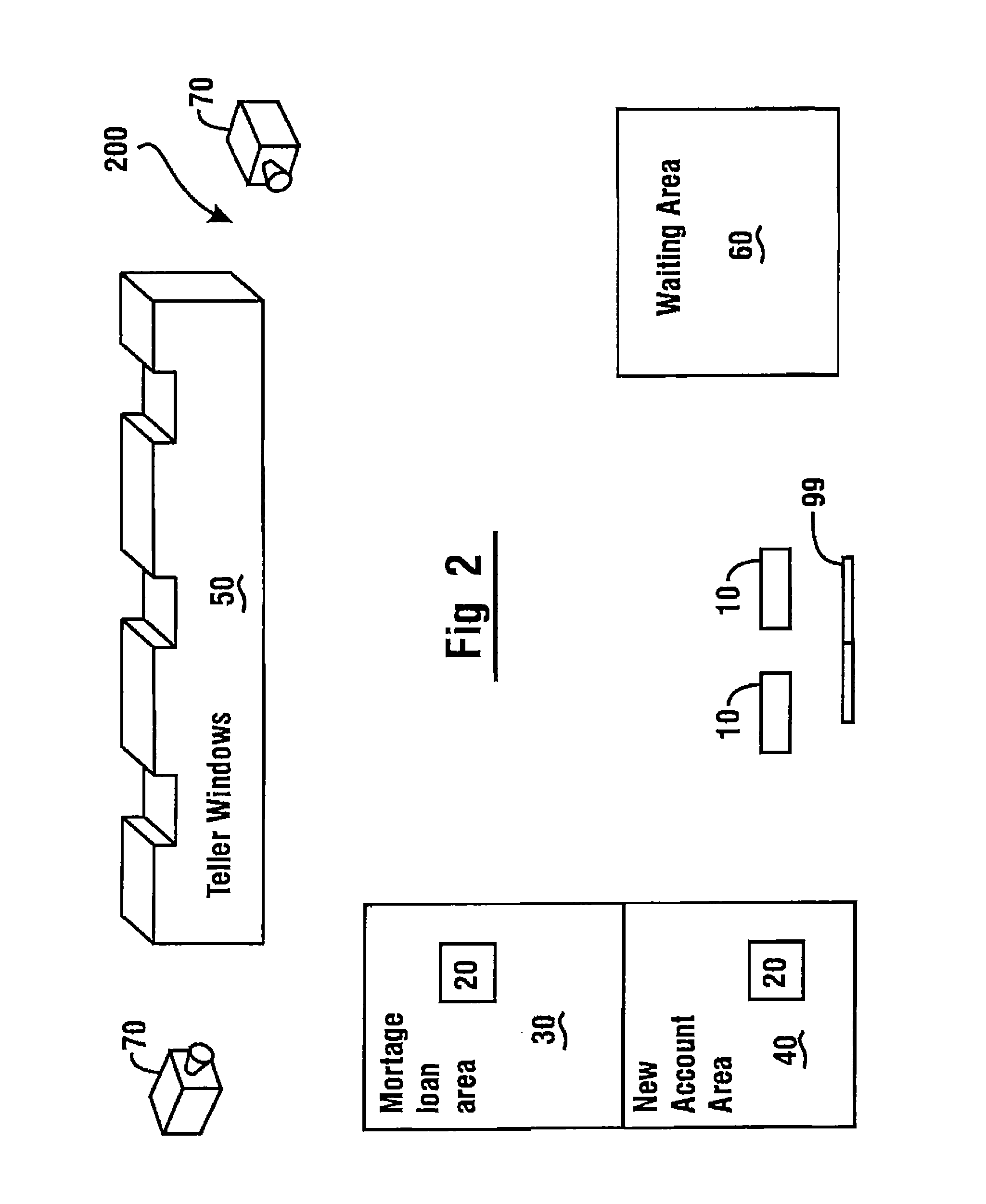

Automated banking machine with remote user assistance

InactiveUS8955743B1Accelerating transactionResponses generated by the at least one computer may be made quicker and shorterComplete banking machinesFinanceEngineeringUser assistance

In an example embodiment, an automated banking machine that allows a customer to employ a mobile wireless device for performing banking transactions. The customer may request assistance from a teller or other bank personnel at a remote location. An audio, and optionally video, communication may be initiated between the remote location and the customer. The customer may use either the automated banking machine, mobile wireless device, or both for communicating with the remote location.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

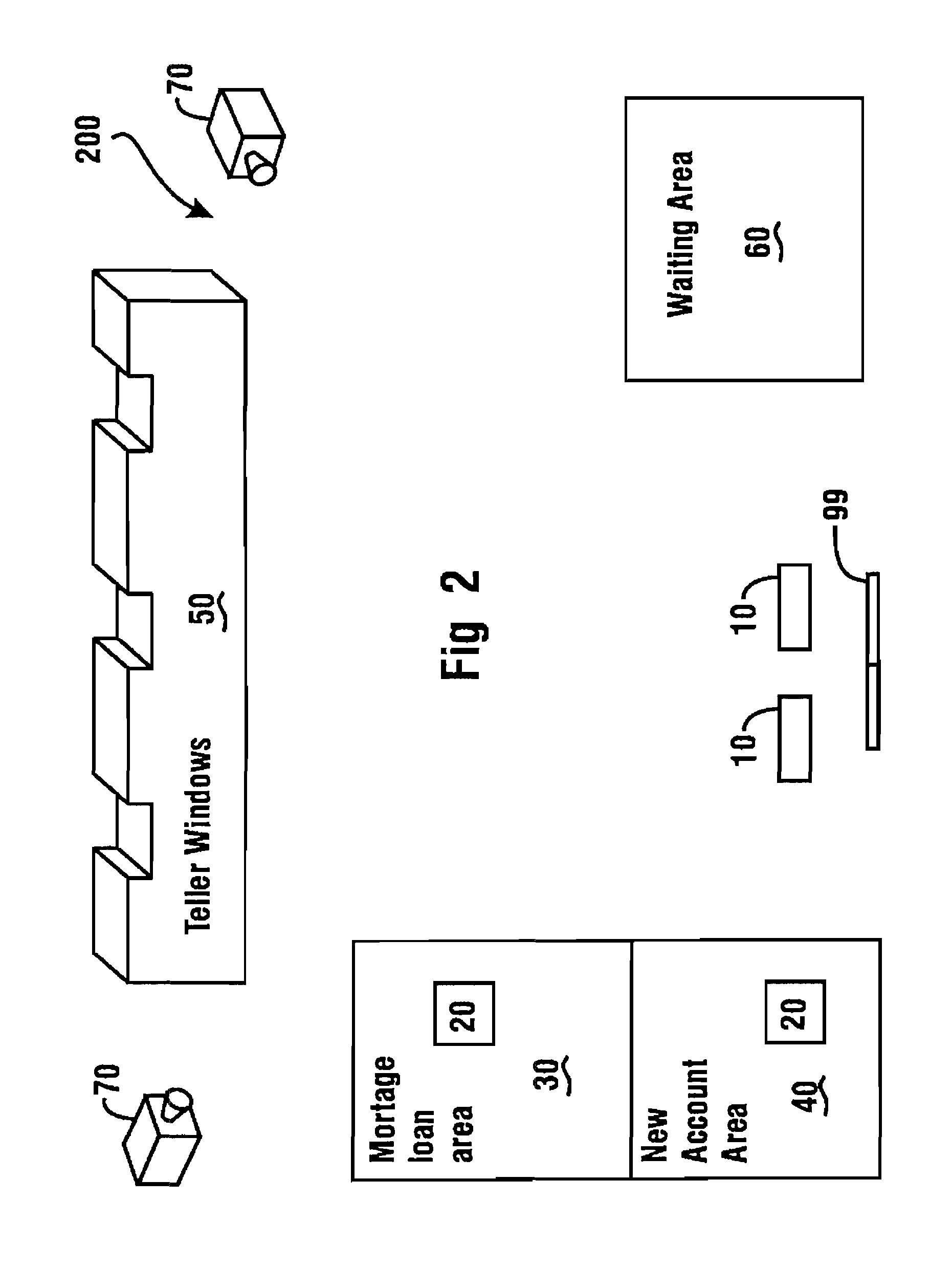

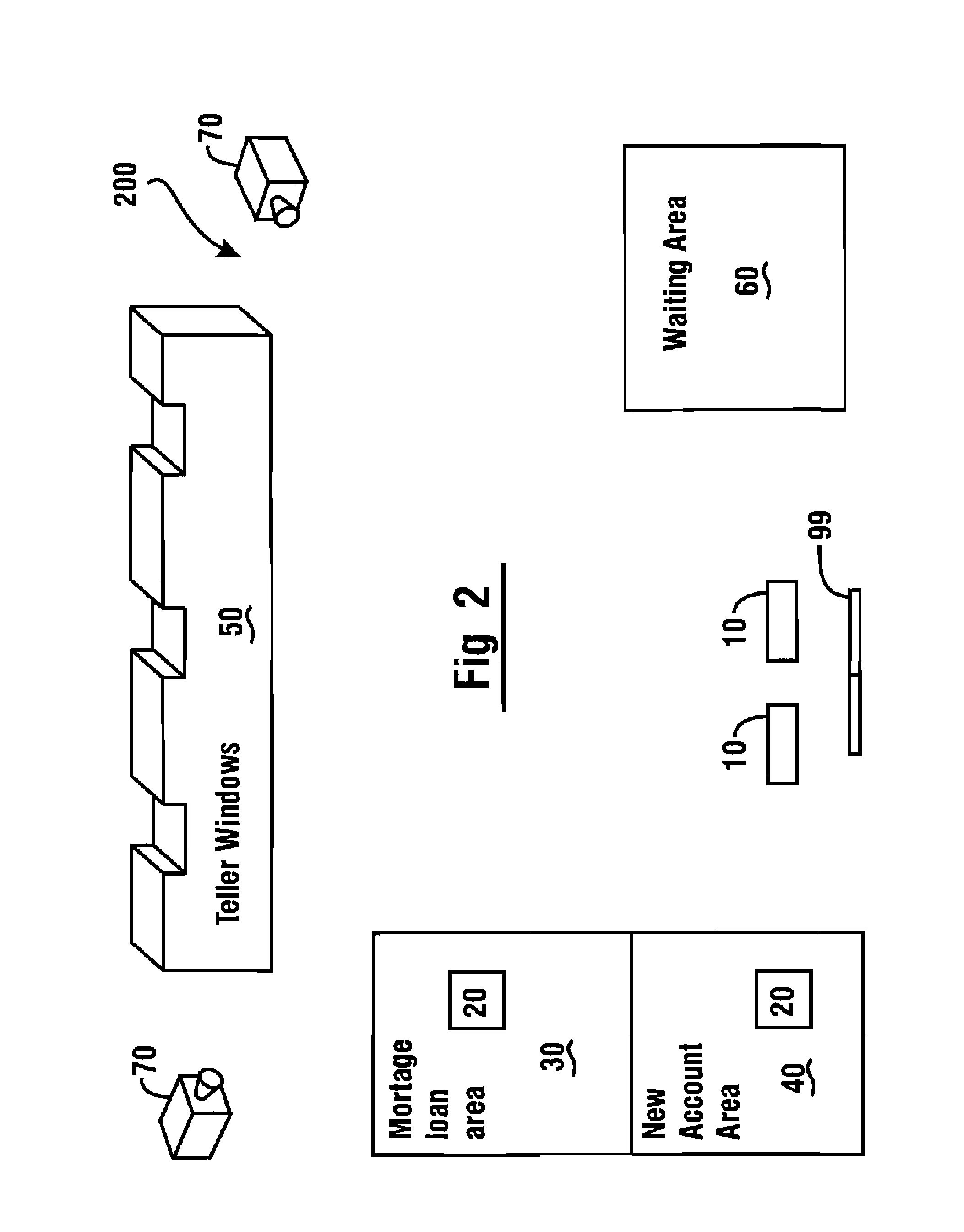

Automated banking machine that enables multiple users to conduct concurrent transactions at different areas of a display surface

ActiveUS7712657B1Accelerating transactionQuicker and shorterComplete banking machinesFinanceDisplay deviceCard reader

An automatic banking machine includes at least one computer, a card reader, transaction function devices, and a display. The display includes a touch display surface having multiple spaced user locations at which transaction sessions by different user can be concurrently conducted. Multiple users can at the same time receive visible outputs from the display surface and provide inputs through physical contact with the display surface. An eye sensing device enables the display surface, based on sensing where a user is looking at the display surface, to display data at the user location.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

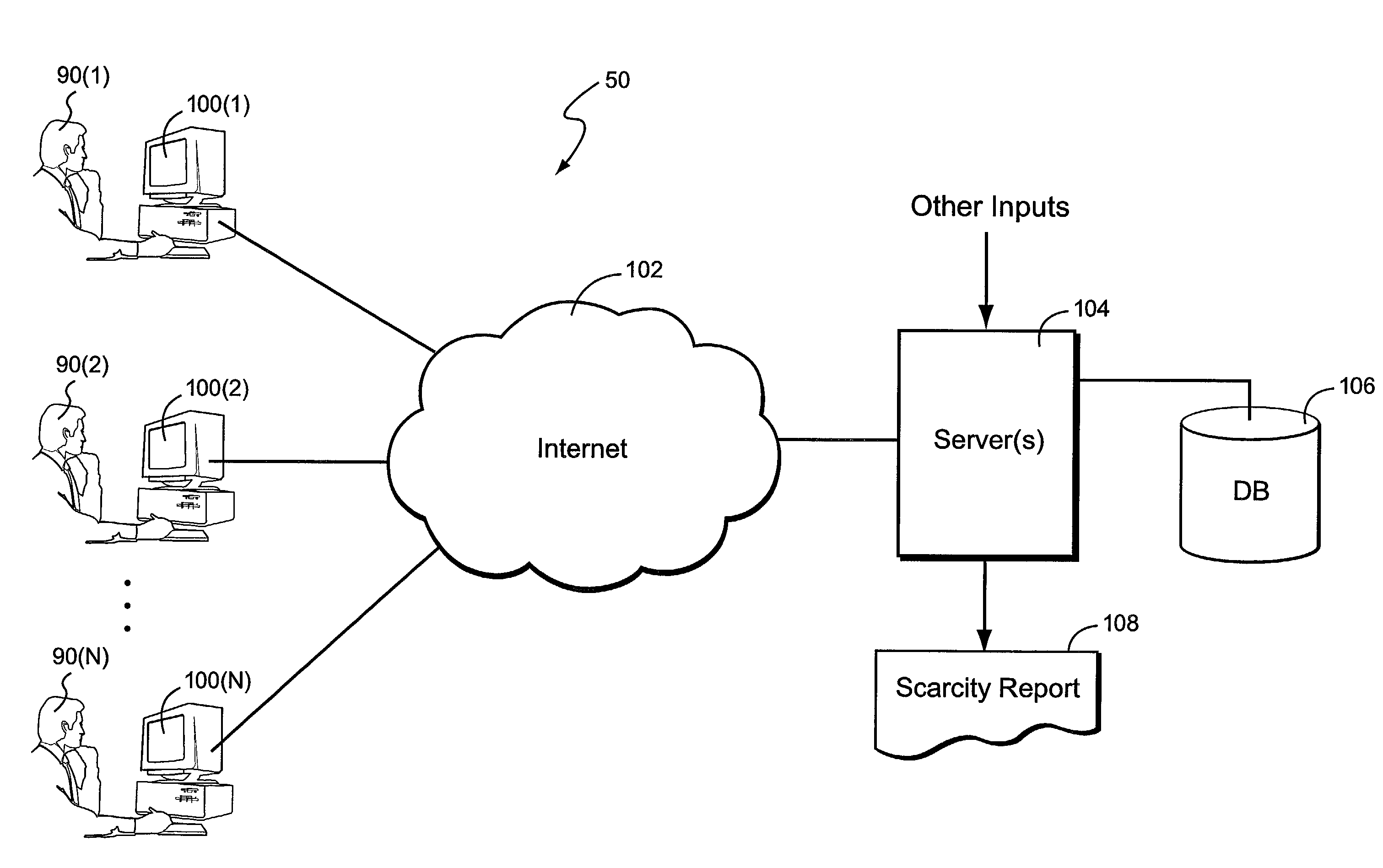

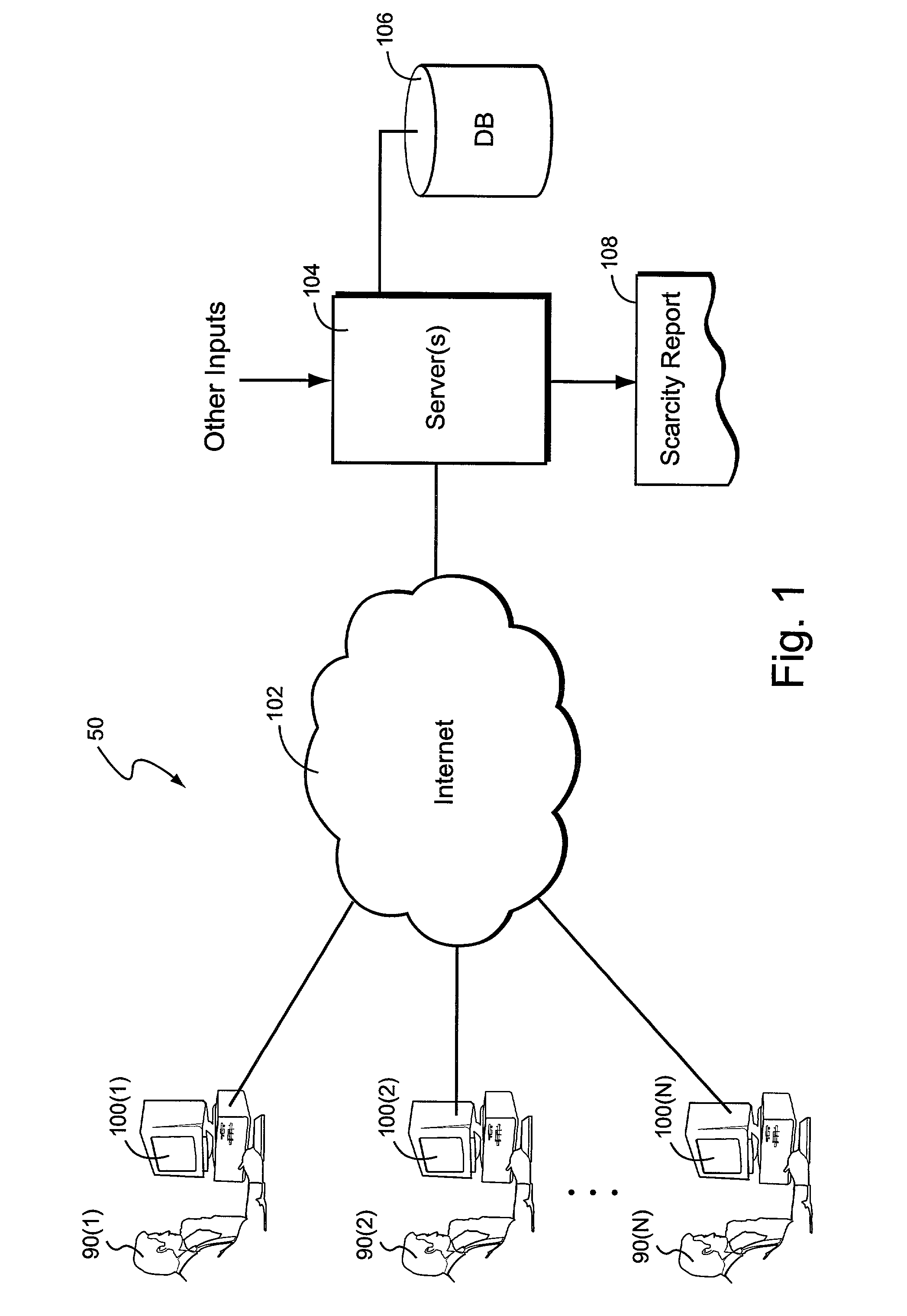

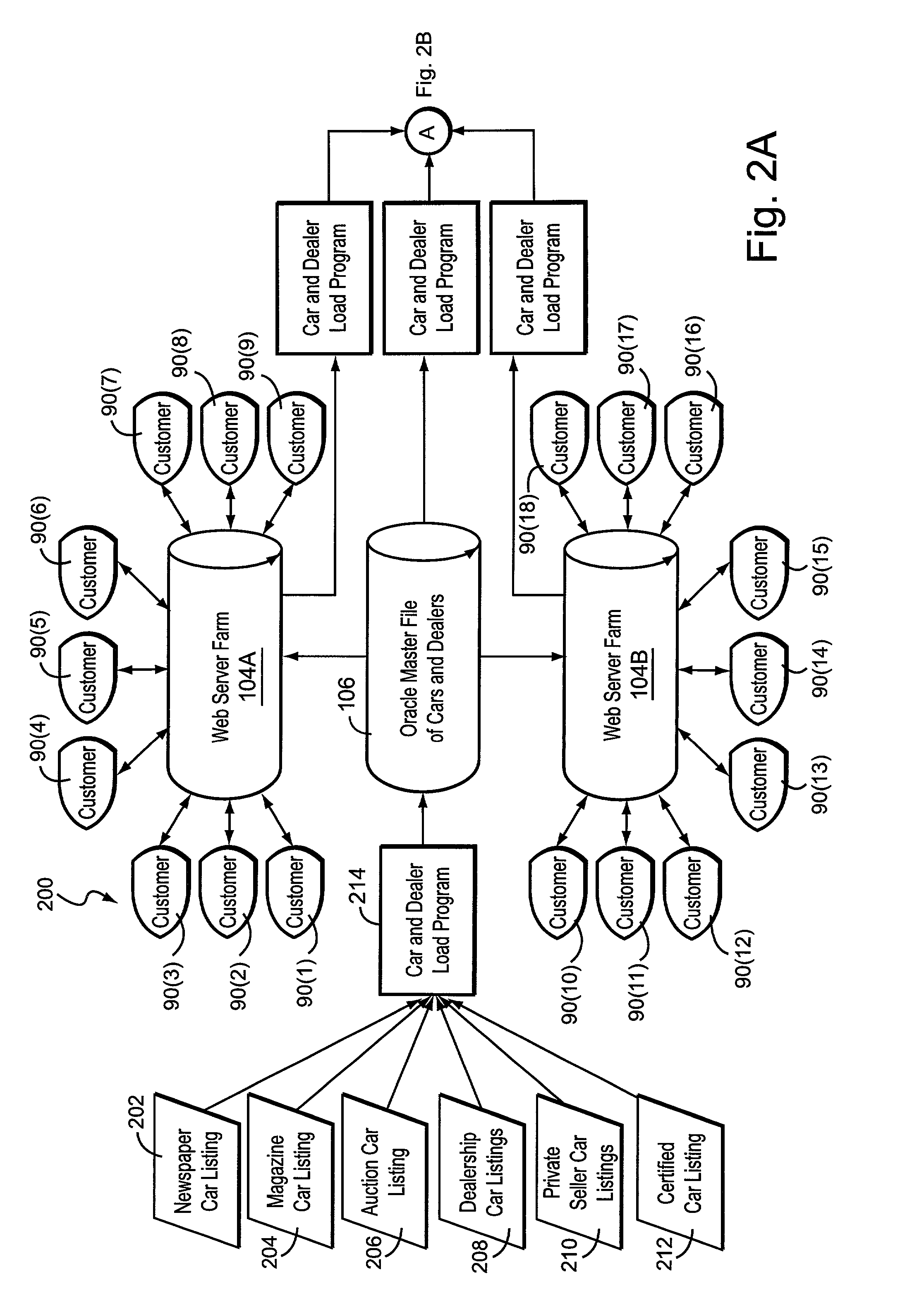

Computer-based system and method for determining a quantitative scarcity index value based on online computer search activities

ActiveUS8521619B2Facilitated and enhanced marketingEfficient searchBuying/selling/leasing transactionsMarketingConsumer demandData mining

An online product or service listing arrangement logs searches performed and uses the logged information to calculate a scarcity index that measures the scarcity of products and services. Scarcity may indicate the number of searches that consumers have conducted compared to available listings. Empirical techniques are used to take into account certain types of searches that may not accurately reflect actual consumer demand. Reports may compare item scarcity within different geographical or other markets to determine relative scarcity. Particularly advantageous but non-limiting applications include new and used motor vehicles, employment opportunities, and real estate.

Owner:AUTOTRADER COM

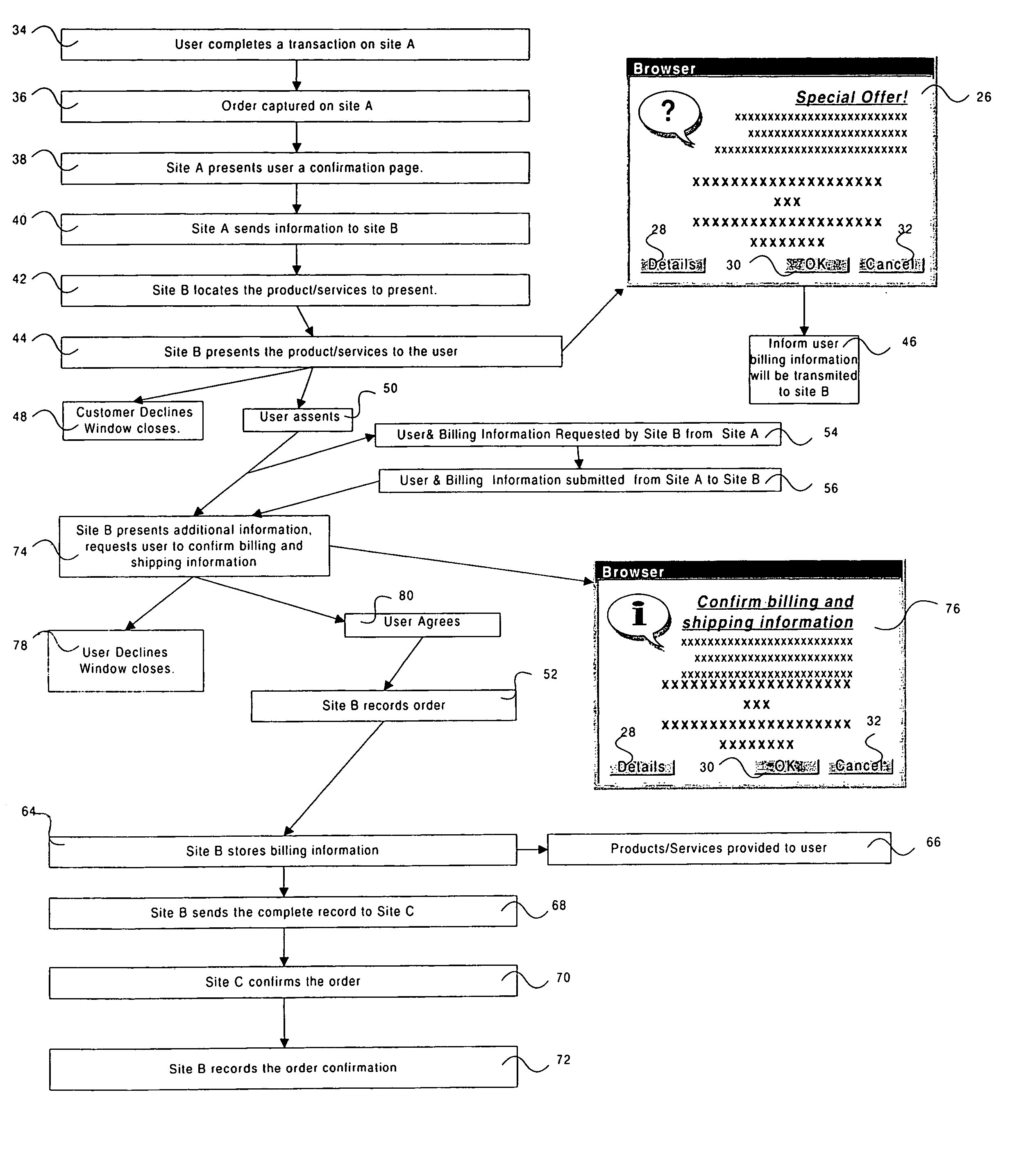

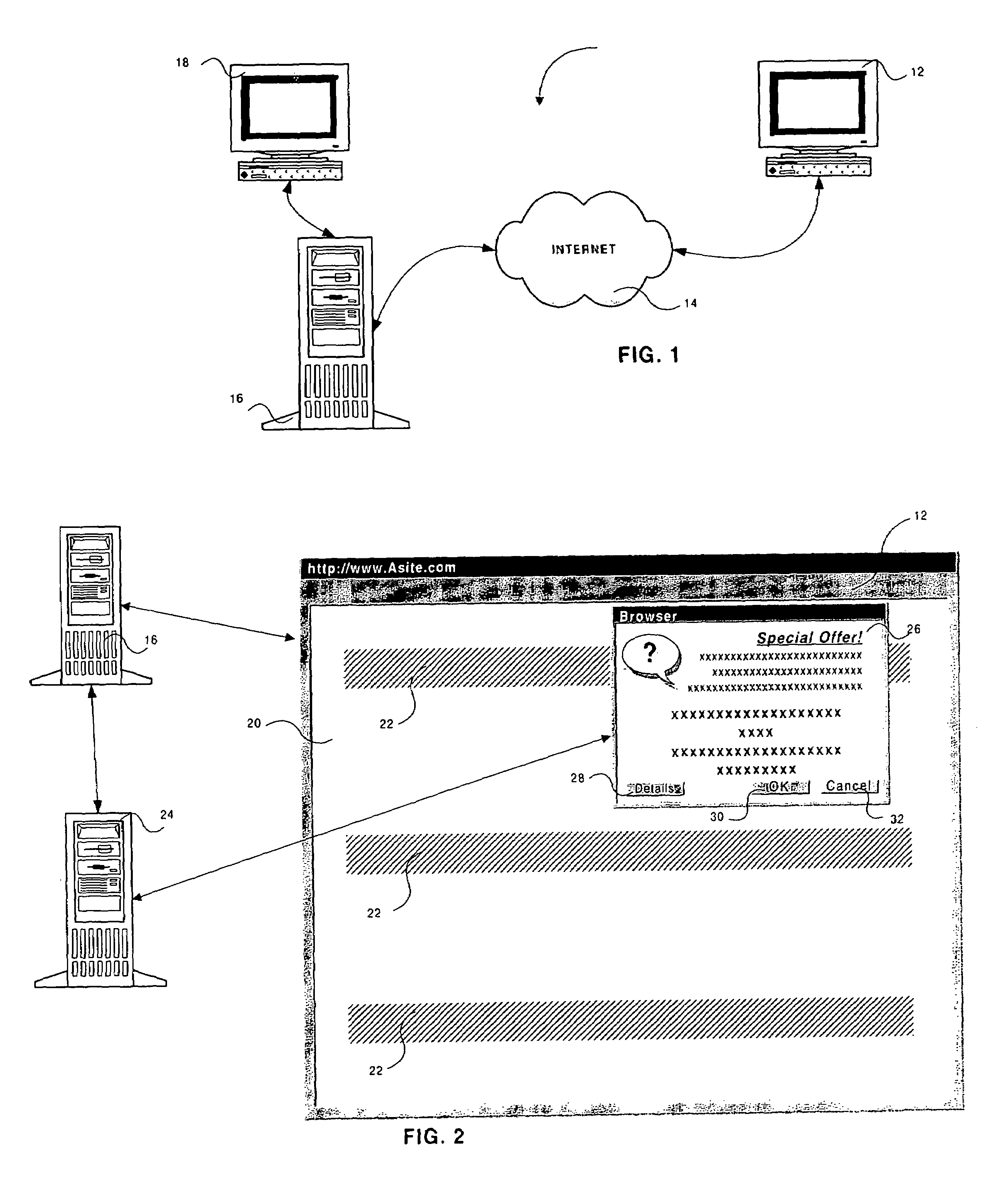

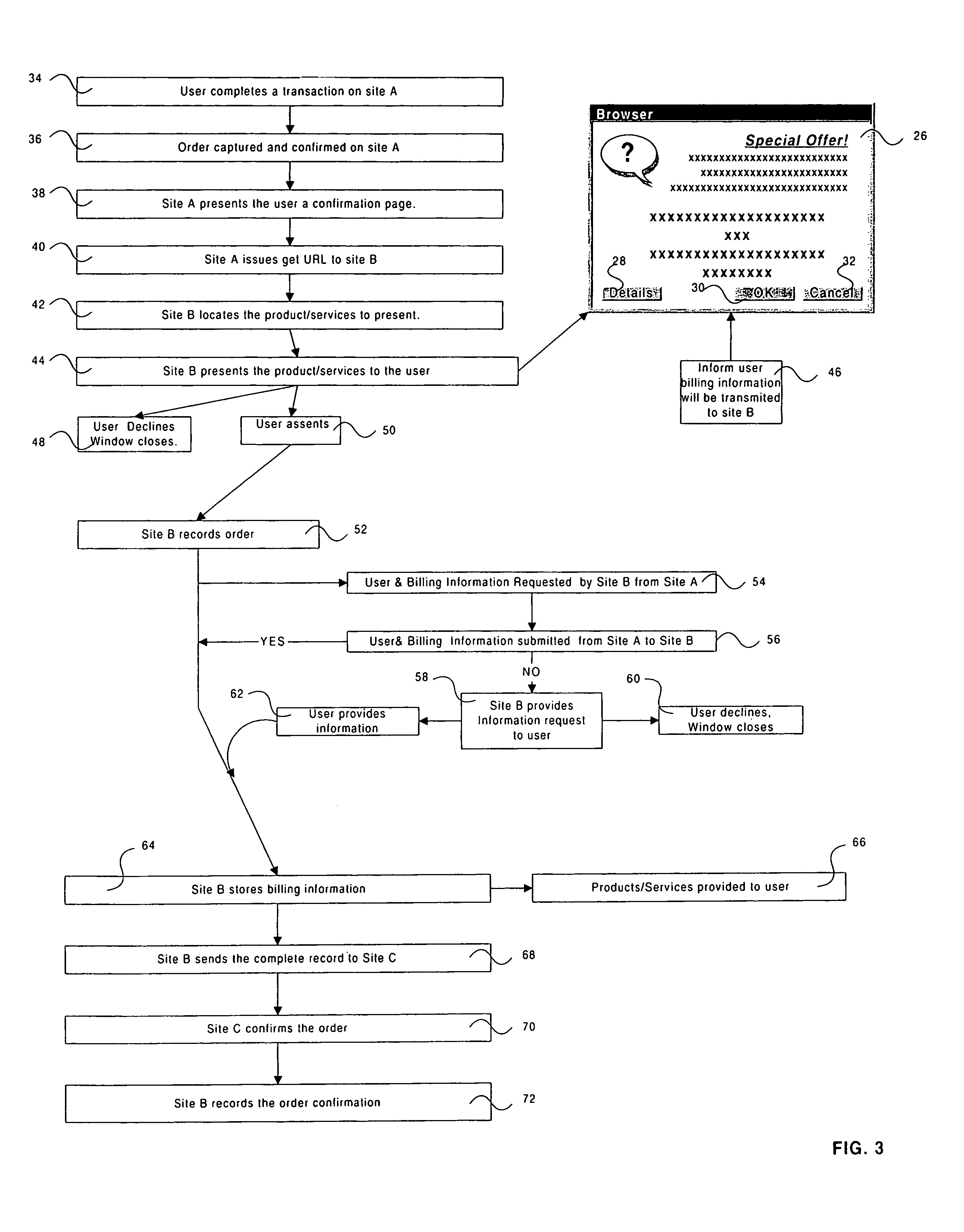

Communication enhancement means

InactiveUS7072856B1Eliminate needIncreasing post-sale transactionBuying/selling/leasing transactionsElectronic credentialsSubject matterThe Internet

A method and system for placing an order for an item via the Internet. The item may be related to the subject matter of a first site being visited by a user or may be related to the subject matter of a purchase transaction conducted by the user on the first site. The first site issues a request to a second site to provide a related item from purchase by the user. The second site provides a display component having actuation unit thereon for the user to assent to or decline the purchase of the related item. If the user declines the item, the display component is removed. If the user assents to the purchase of the item, the second site receives the billing and user information from the first site in a secure fashion, and the item is delivered to the user either by the second site or by outsourcing.

Owner:NACHOM AL

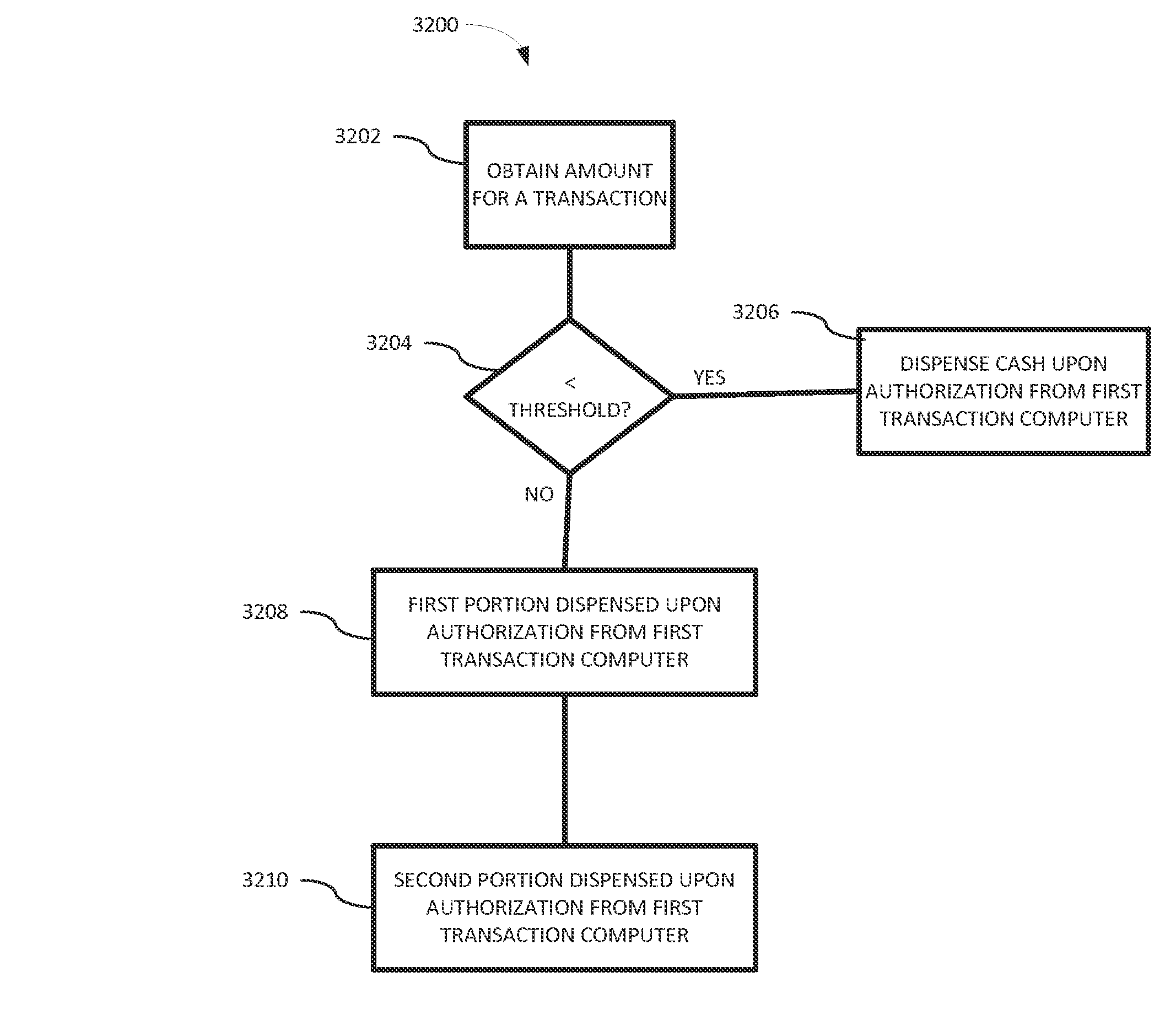

Processing automated banking transactions requiring approval

ActiveUS9355530B1Accelerating transactionComplete banking machinesFinanceFinancial transactionAuthorization

In an example embodiment, an automated banking machine operable to perform cash withdrawals. If a withdrawal is below a threshold, authorization is obtained from a first transaction authorization computer. If a withdrawal is greater than or equal to the threshold, a first portion of the cash is dispensed responsive to authorization from a first transaction authorization computer and a second portion of the cash amount is dispensed responsive to authorization from a second transaction authorization computer.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

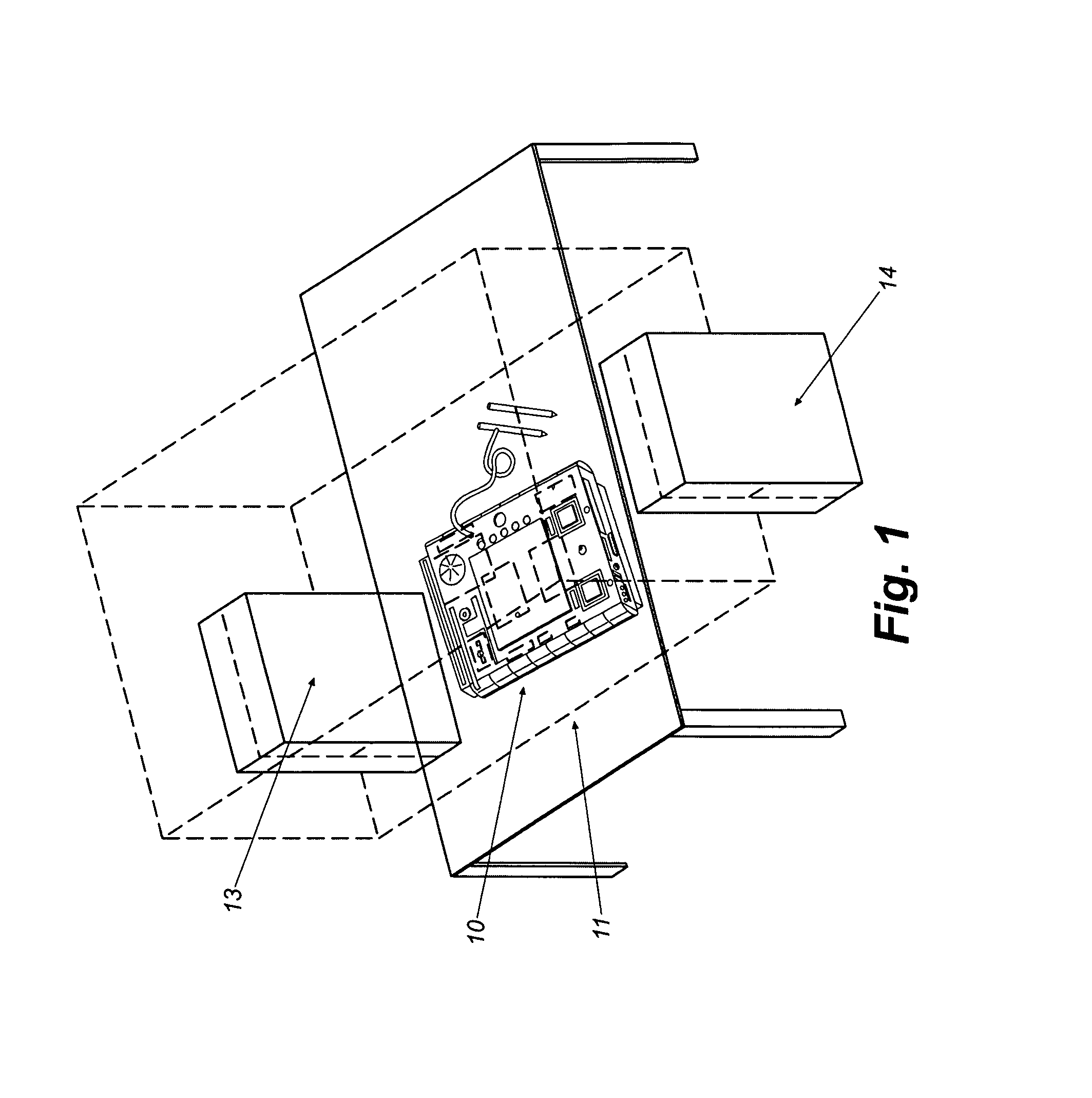

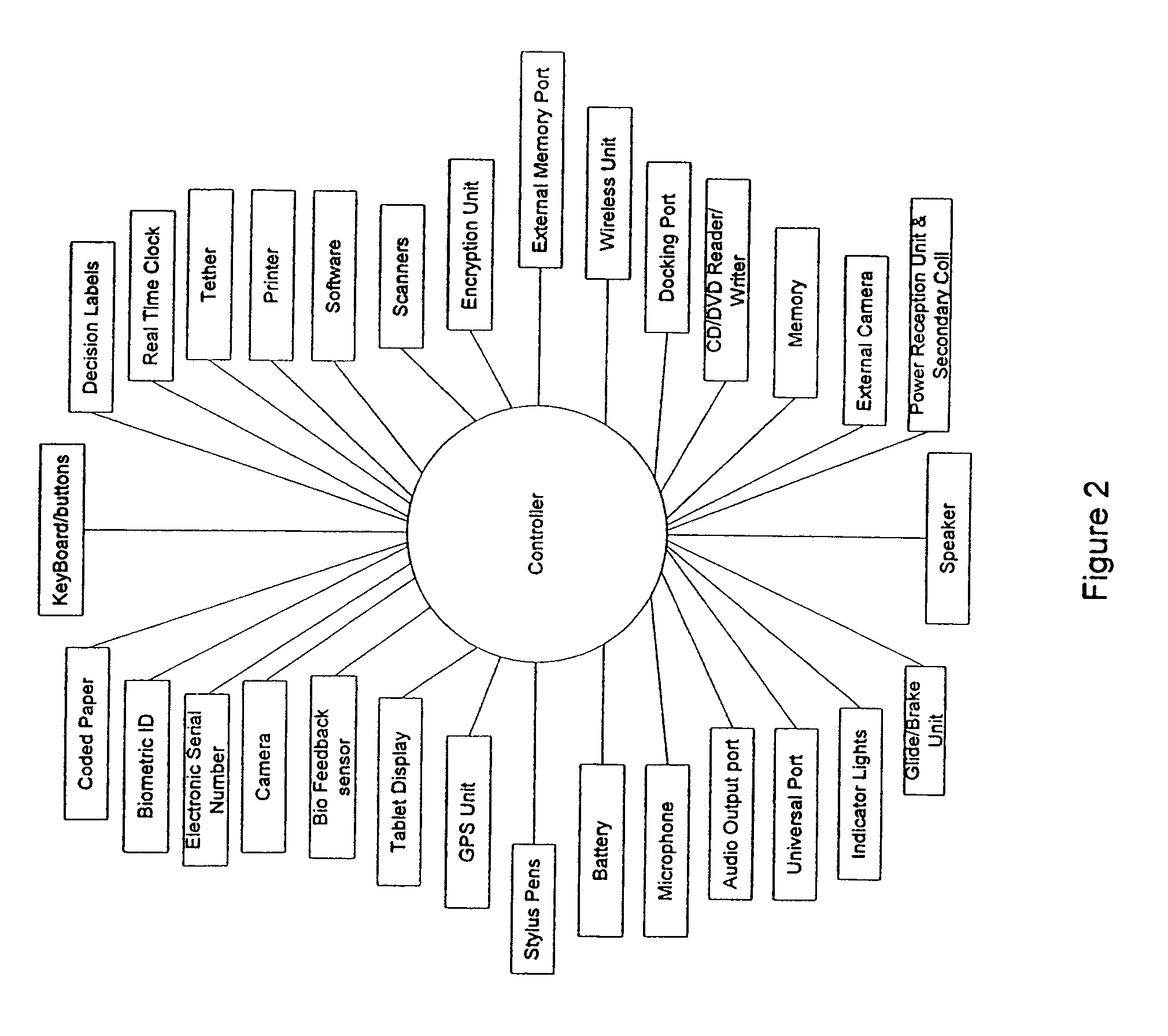

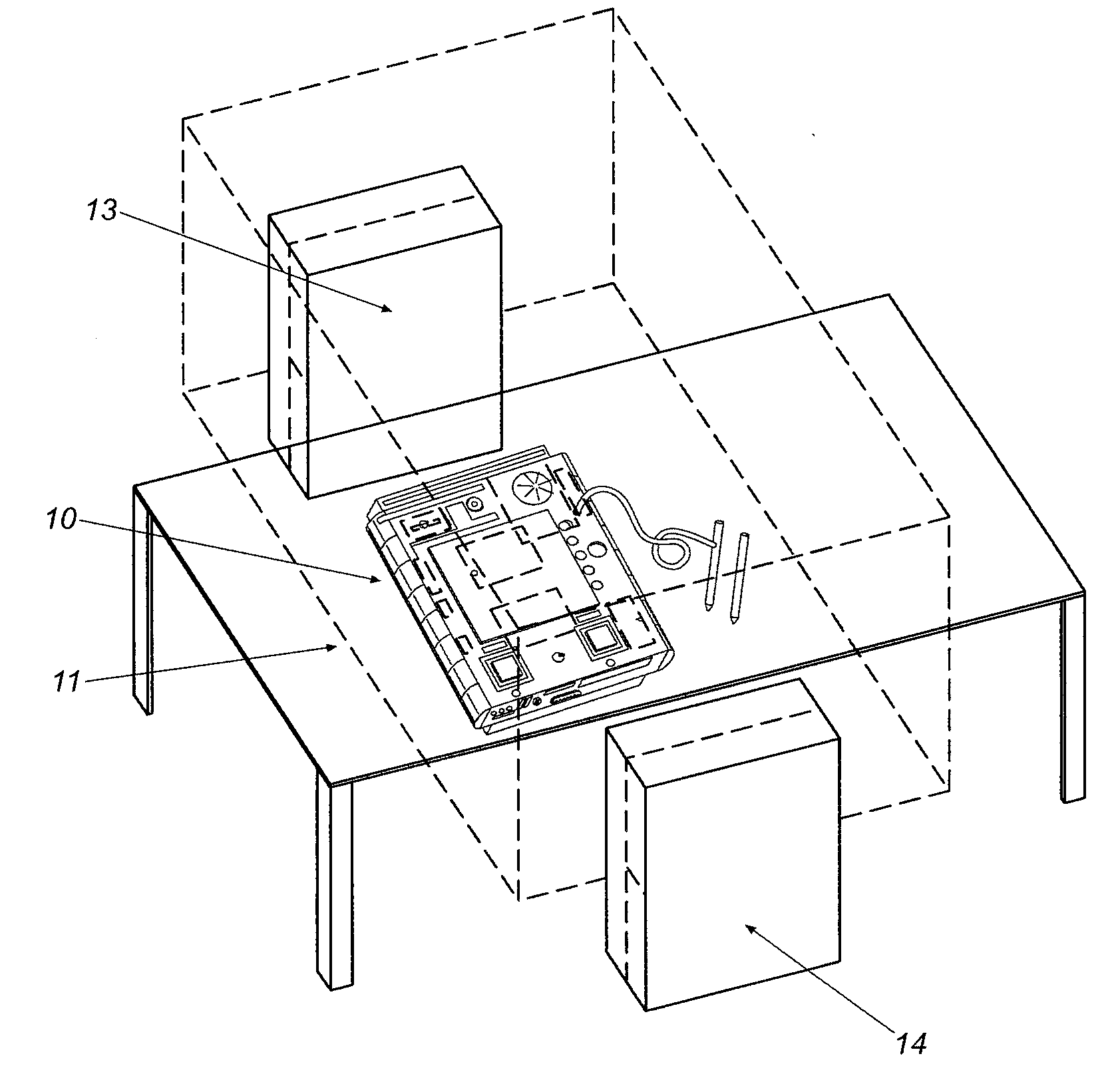

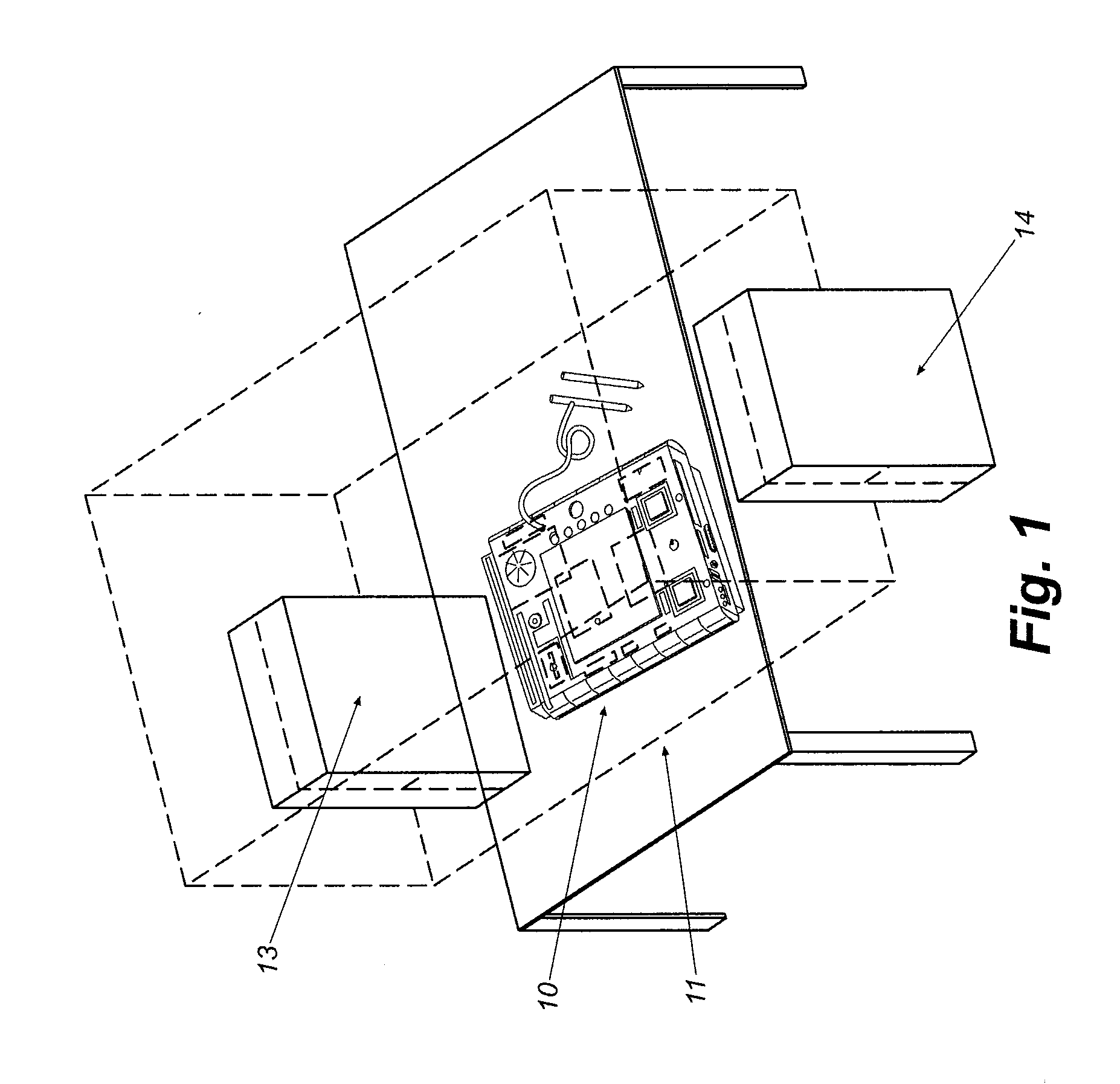

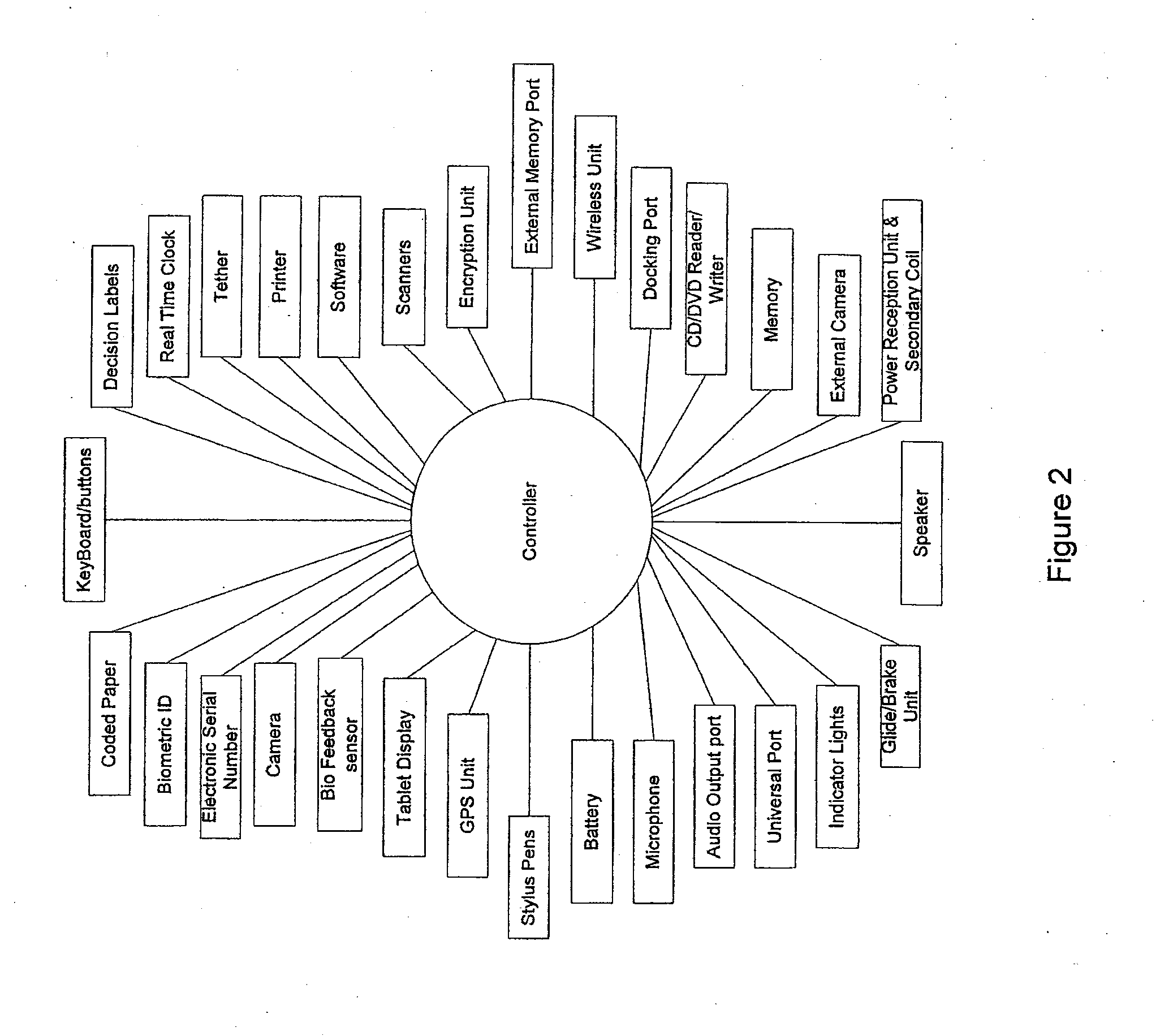

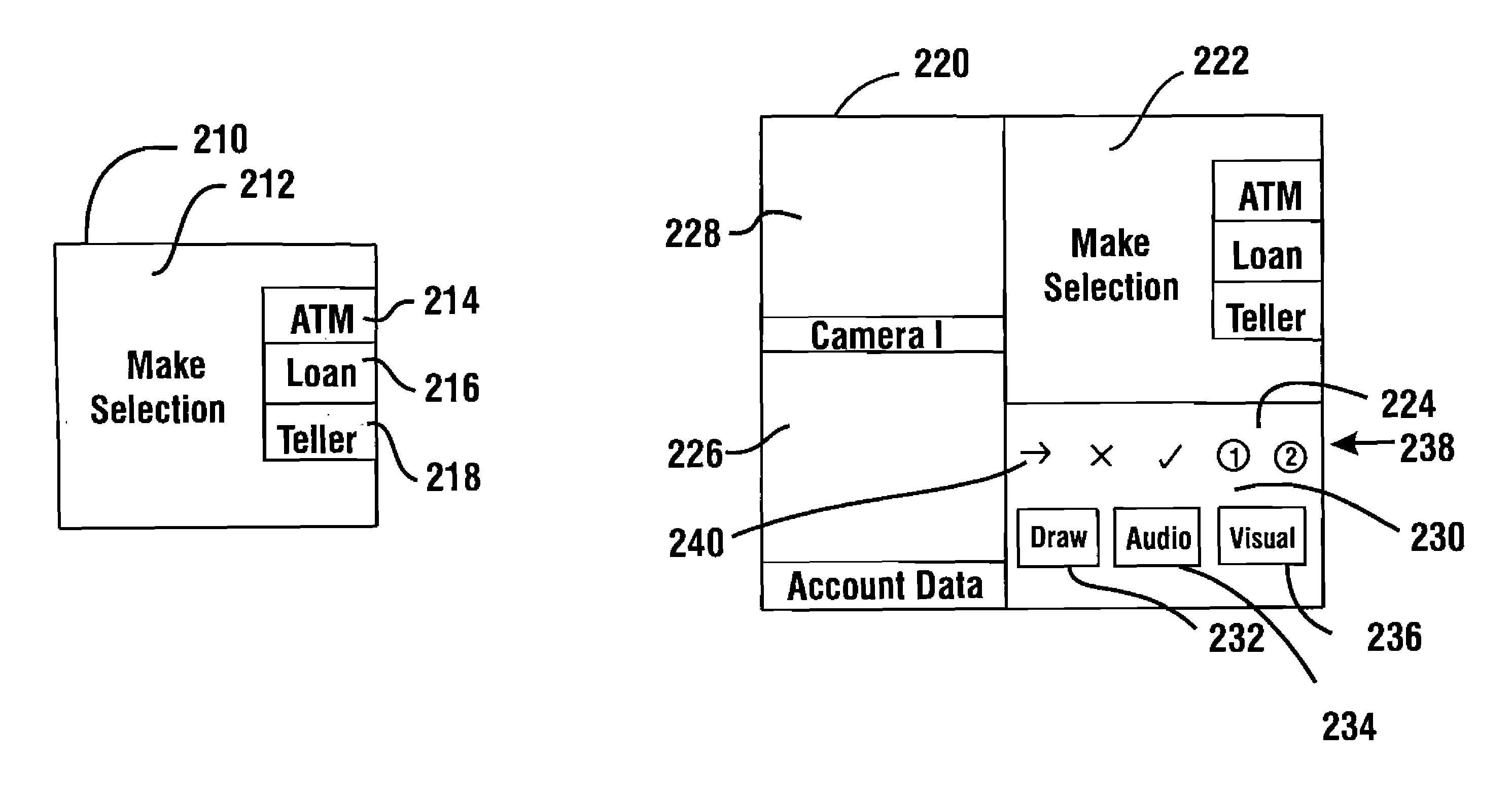

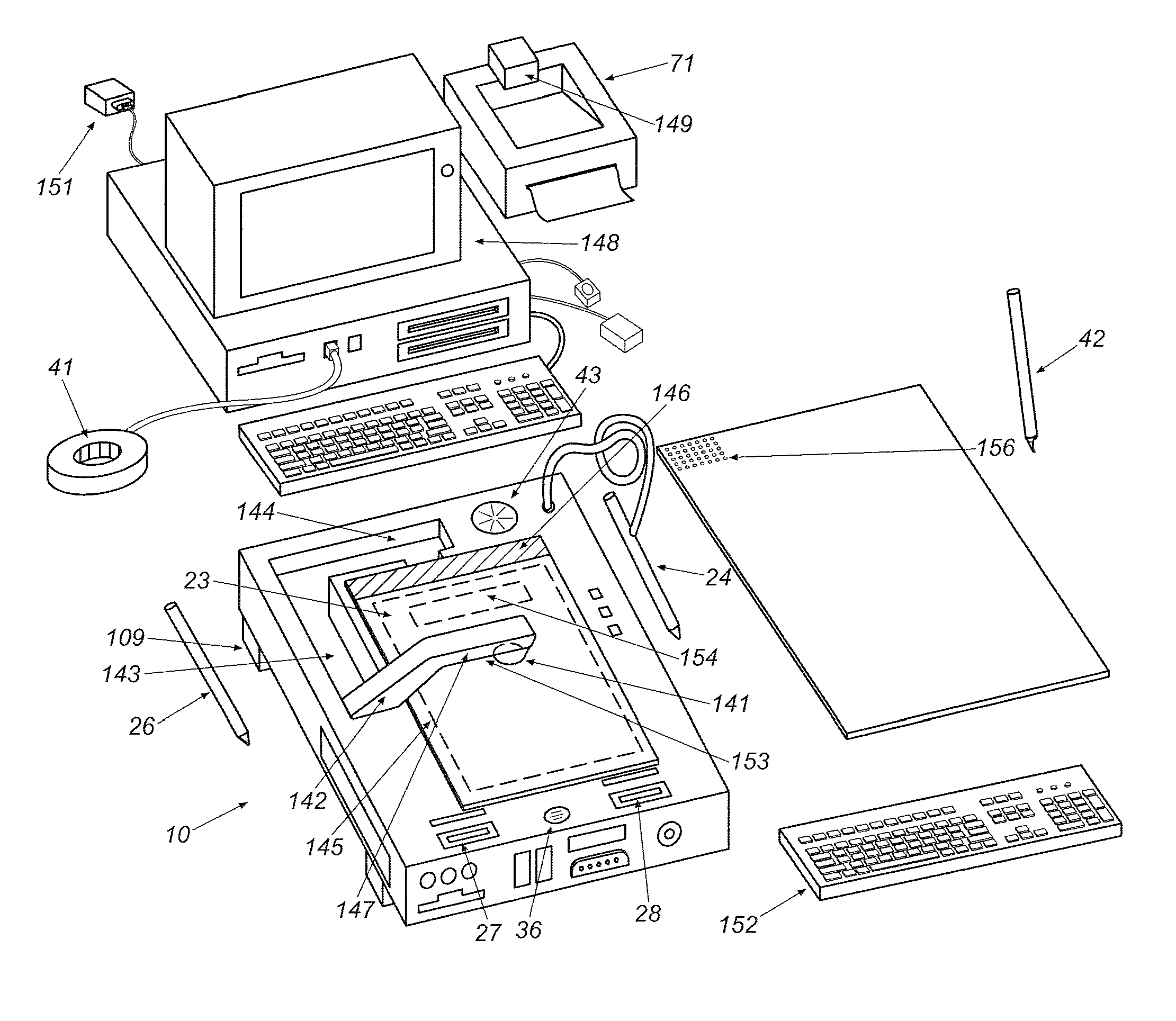

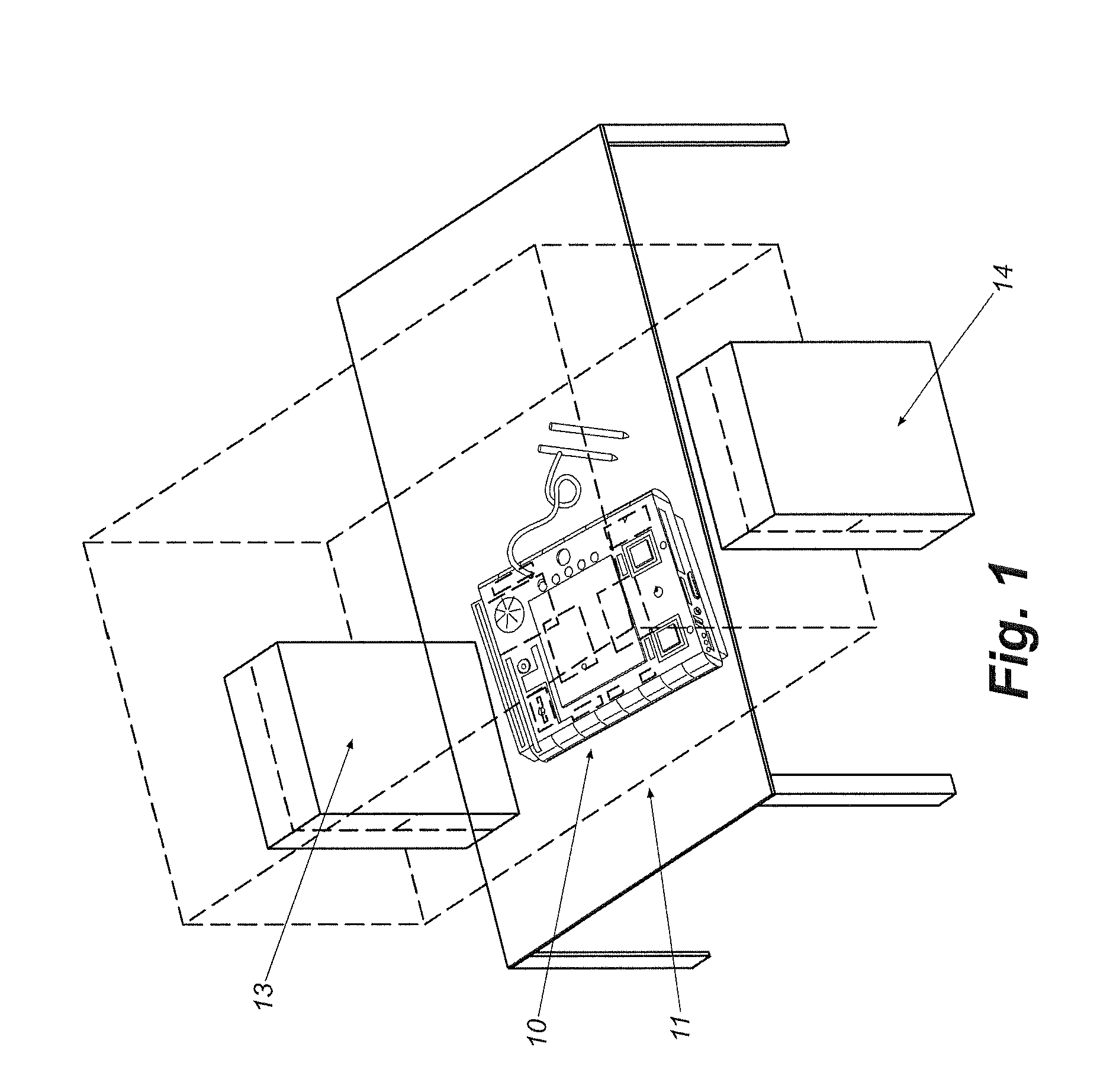

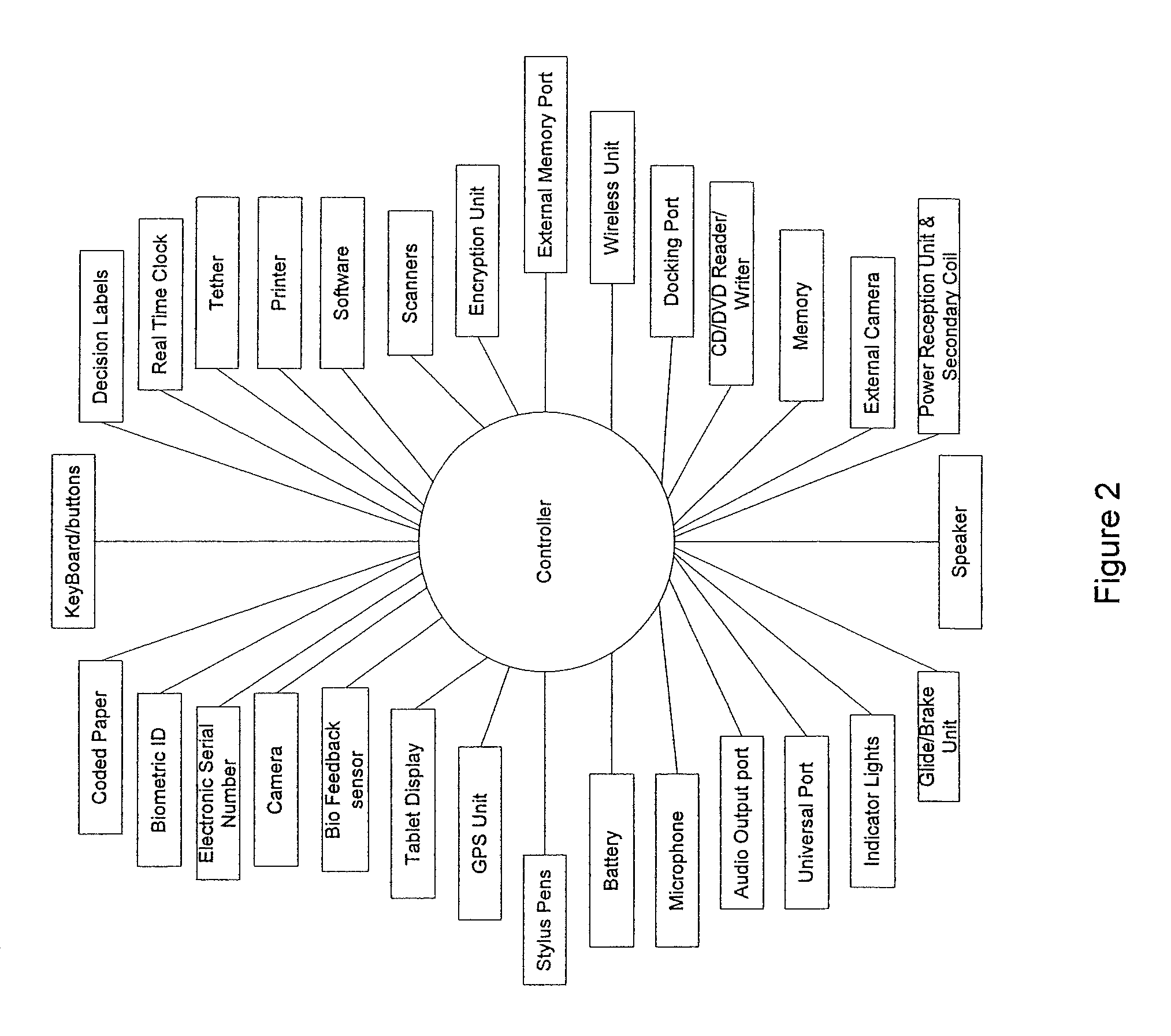

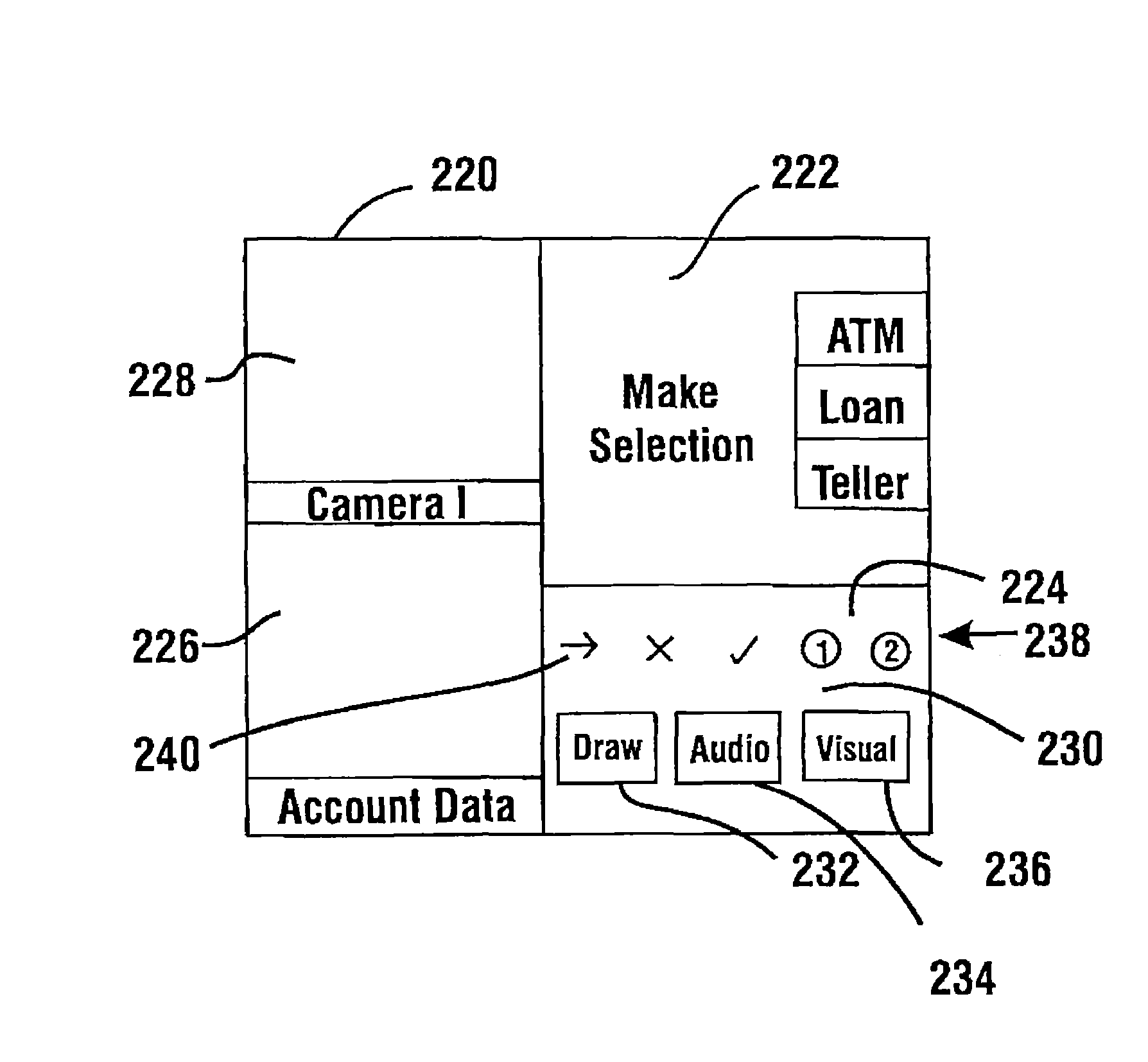

Transaction Automation And Archival System Using Electronic Contract Disclosure Units

ActiveUS20120117467A1Accelerating transactionEasy to useFinanceCathode-ray tube indicatorsDocumentation procedureElectronic contracts

A transaction automation and archival system is provided for controlling, real-time logging, and archiving complex commercial transactions such as the purchase and financing of an automobile. An electronic contract disclosure unit or ECDU includes a digitizing display that includes a video display for imaging to participants the various documents involved in the transaction and a digitizer for allowing participants to sign, indicate choices, and otherwise interact directly on documents and images presented on the display. A computer controls the progress of the transaction, controlling, for example, the order of presentation of documents to a vehicle purchaser, receiving signatures on the displayed documents, offering choices of various packages to the purchaser, and insuring that the transaction is carried out properly. The transaction is logged for future review which may include a video record. One or more fingerprint readers allow participants to select between options while simultaneously verifying the identity of the individual making the selection.

Owner:REYNOLDS AND REYNOLDS

ATM that allows a user to select a desired transaction by touch dragging a displayed icon that represents the desired transaction

InactiveUS8640946B1Accelerating transactionQuicker and shorterComplete banking machinesFinanceDisplay deviceFinancial transaction

An automated banking machine allows an authorized user to carry out transactions such as withdrawing cash, making a deposit, cashing a check, and transferring funds between accounts. The machine provides a transaction selection screen through a touch screen display. The transaction selection screen includes a plurality of visually different icons. Each icon represents a different transaction that is available to the current machine user. The user can select a particular transaction by dragging its representative icon with a contacting finger. Upon selection of the particular transaction, a display screen unique to that particular transaction is then provided through the touch screen display.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

ATM that allows a user to select a desired transaction by touch dragging a displayed icon that represents the desired transaction

InactiveUS8651373B1Accelerating transactionQuicker and shorterComplete banking machinesFinanceDisplay deviceFinancial transaction

An automated banking machine allows an authorized user to carry out transactions such as withdrawing cash, making a deposit, cashing a check, and transferring funds between accounts. The machine provides a transaction selection screen through a touch screen display. The transaction selection screen includes a plurality of visually different icons. Each icon represents a different transaction that is available to the current machine user. The user can select a particular transaction by dragging its representative icon with a contacting finger. Upon selection of the particular transaction, a display screen unique to that particular transaction is then provided through the touch screen display.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

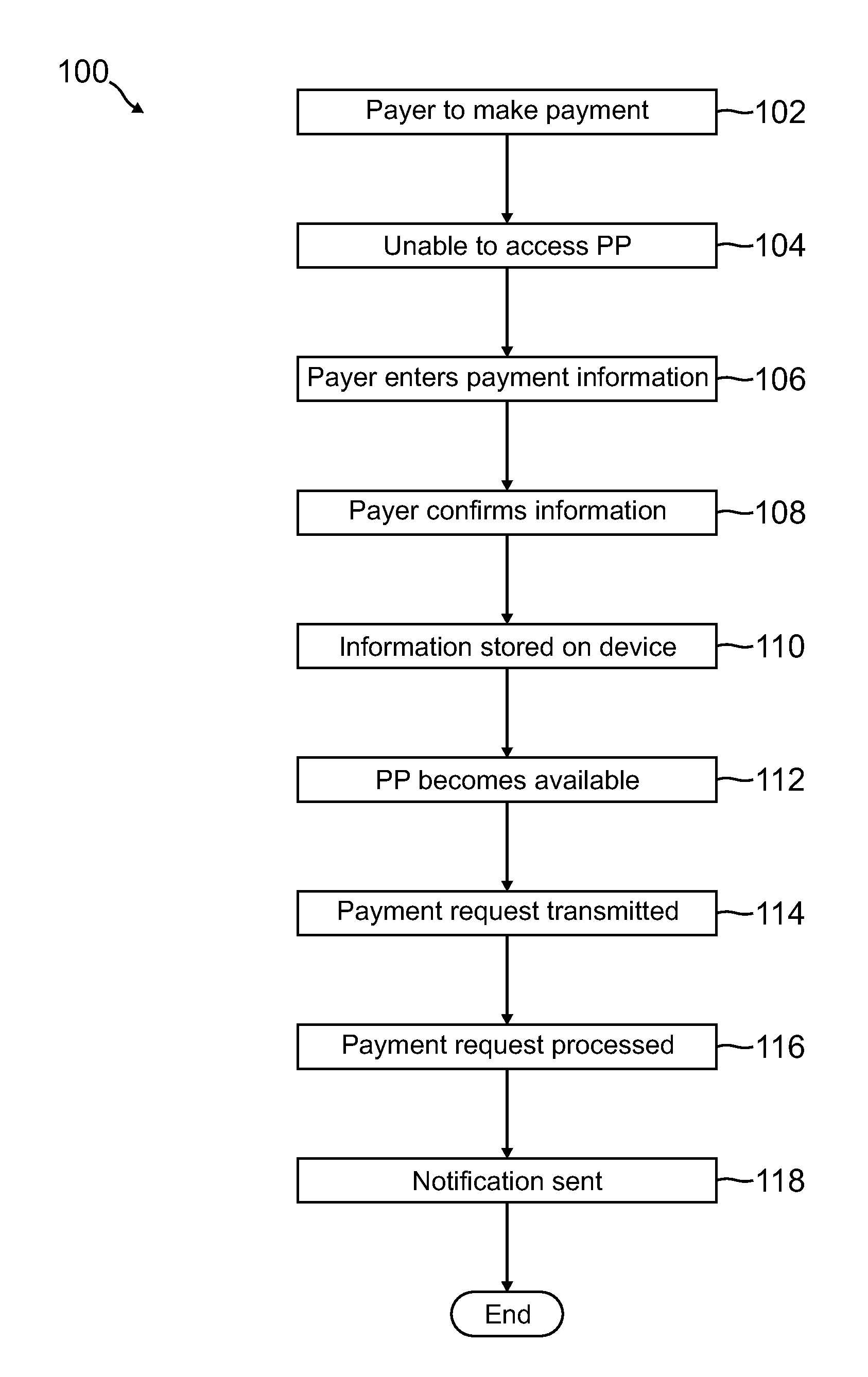

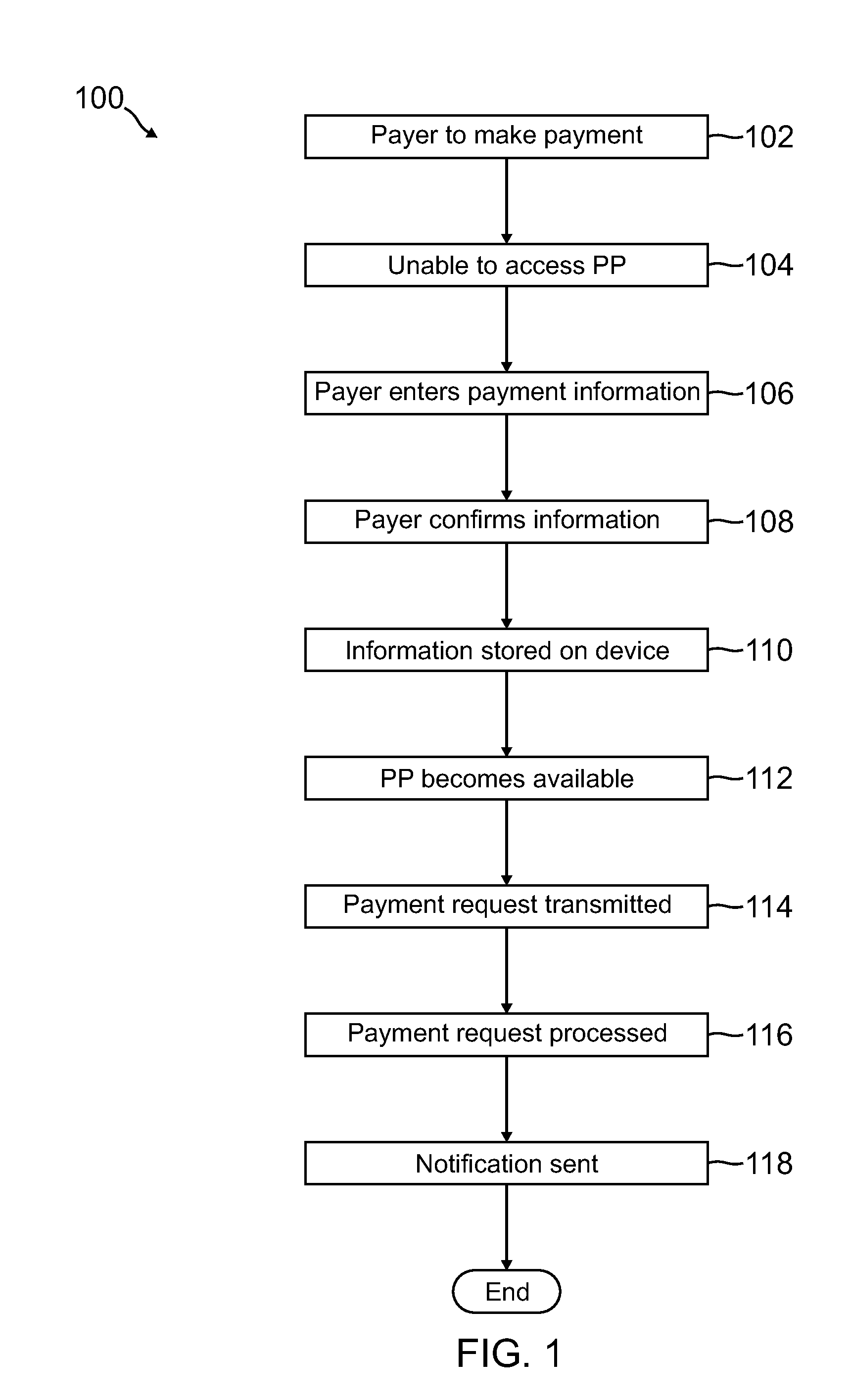

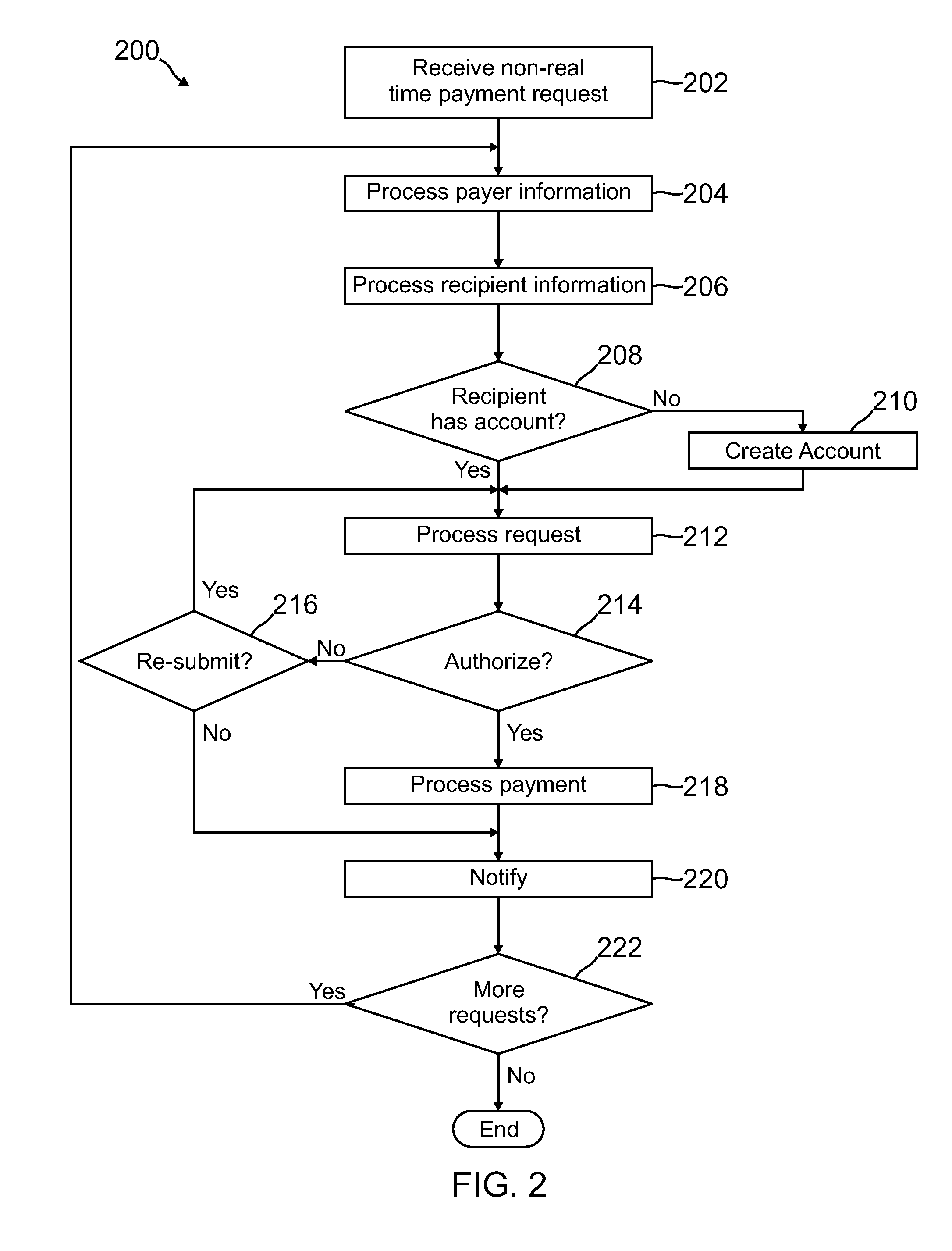

Offline to online payment

InactiveUS20120078789A1Accelerating transactionTransaction can be blockedFinanceProtocol authorisationTelephonyOnline payment

A payer submits a payment request when there has been no connection established with an online payment provider. The payment request is stored on the payer's device, such as a phone, and is transmitted to the payment provider when a connection is established. The payer can submit a plurality of offline payment requests, all of which can be transmitted and processed when received by the payment provider.

Owner:PAYPAL INC

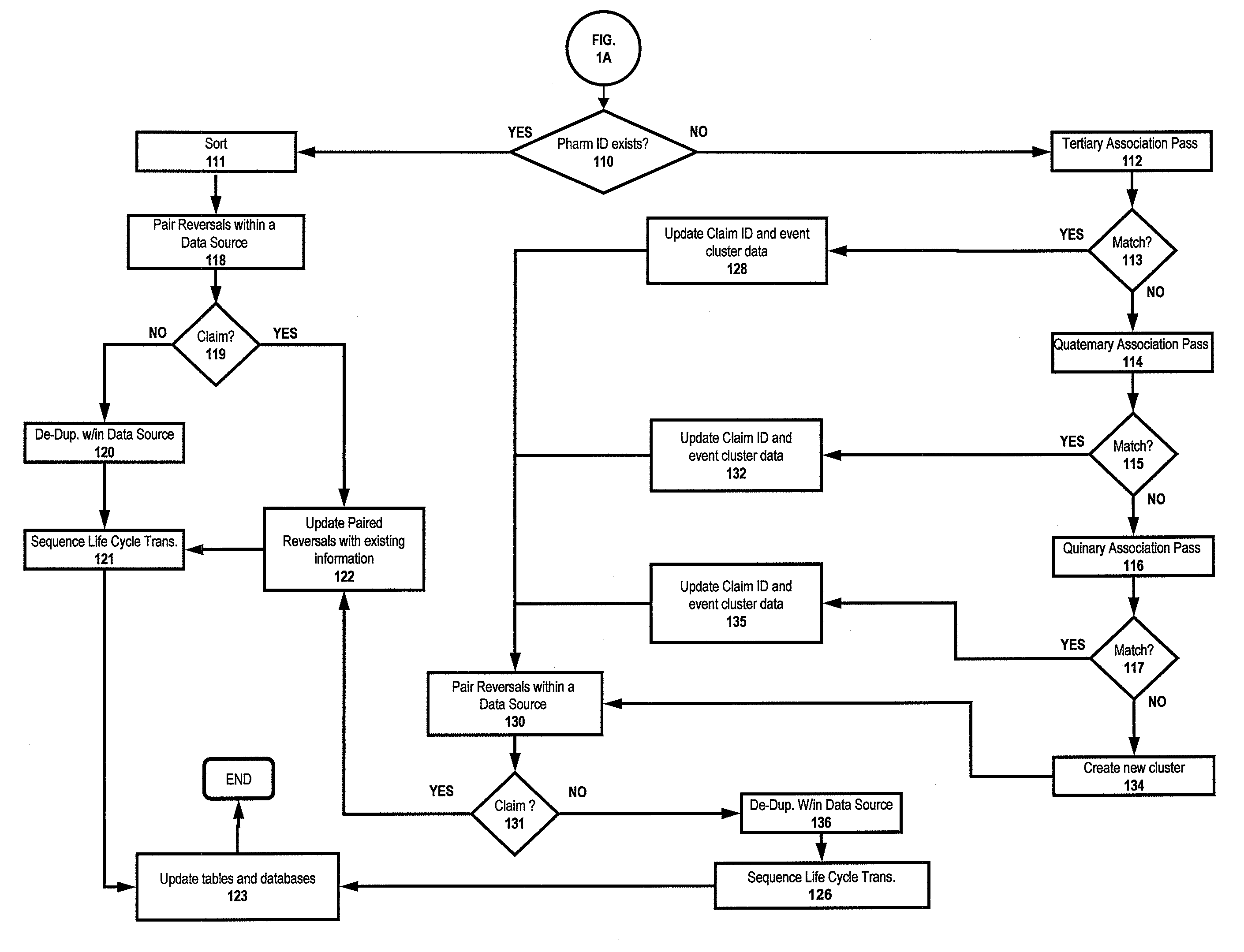

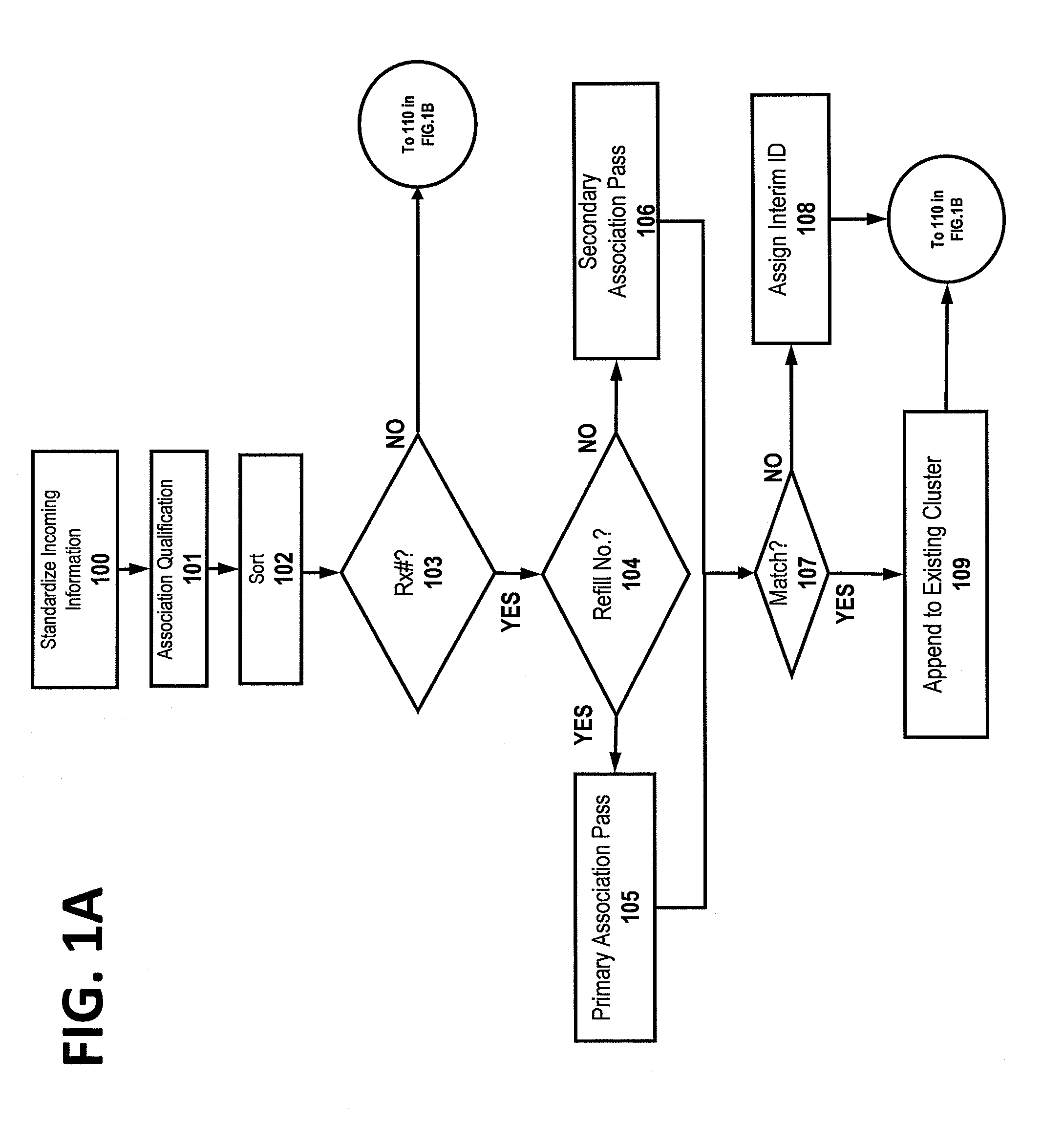

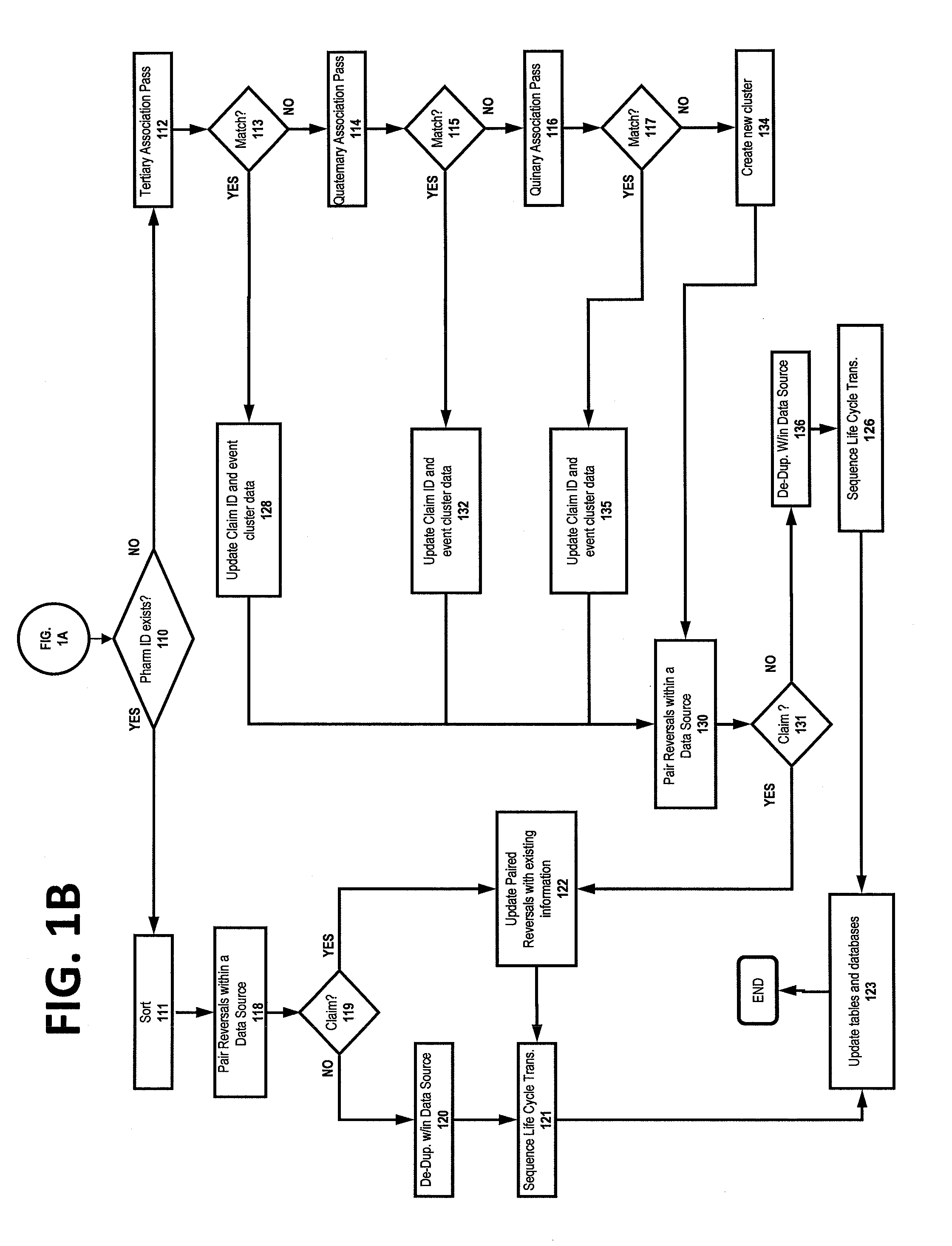

Computer-implemented system and method for associating prescription data and de-duplication

InactiveUS20120185264A1Accelerating transactionDrug and medicationsOffice automationPatient acceptanceData provider

A prescription association system and method for grouping together prescription-related transactions and creating groups or “clusters” of prescriptions having similar characteristics. Through an association process, the prescription cluster describes the events surrounding prescription activity. This includes prescribing patterns, payer influences, and patient acceptance of therapy. The same prescription transaction from one data provider may contain additional or different information that can enhance a corresponding duplicate transaction or set of claim lifecycle transactions from another provider. The disclosed processes create unique linking across claims, payers, and patients and form the basis for relating and measuring payer, patient, practitioner, and pharmaceutical promotion influences on healthcare utilization and treatment.

Owner:SOURCE HEALTHCARE ANALYTICS

Transaction automation and archival system using electronic contract disclosure units

ActiveUS8194045B1Accelerating transactionEasy to useFinanceCathode-ray tube indicatorsDisplay deviceFinancial transaction

A transaction automation and archival system is provided for controlling, real-time logging, and archiving complex commercial transactions such as the purchase and financing of an automobile. The heart of the system is an electronic contract disclosure unit, or ECDU. The ECDU includes a digitizing display that includes a video display for imaging to participants the various documents involved in the transaction and a digitizer for allowing participants to sign, indicate choices, and otherwise interact directly on documents and images presented on the display. A computer controls the entire progress of the transaction, and thus controls the collaborative space occupied by the participants to the transaction. The computer, for instance, controls the order of presentation of documents to a vehicle purchaser, receives the purchaser's signature on the displayed documents when required, offers choices of various packages that can be accepted or declined by the purchaser, and insures that the entire transaction is carried out properly. The ECDU further logs the transaction for future review and preferably includes a video camera and microphone for logging images and sounds of the participants during the transaction. One or more fingerprint readers are associated with the digitizing display for allowing participants to select between options by pressing their thumb or finger on the reader, which simultaneously verifies the identity of the individual making the selection through the fingerprint.

Owner:REYNOLDS AND REYNOLDS

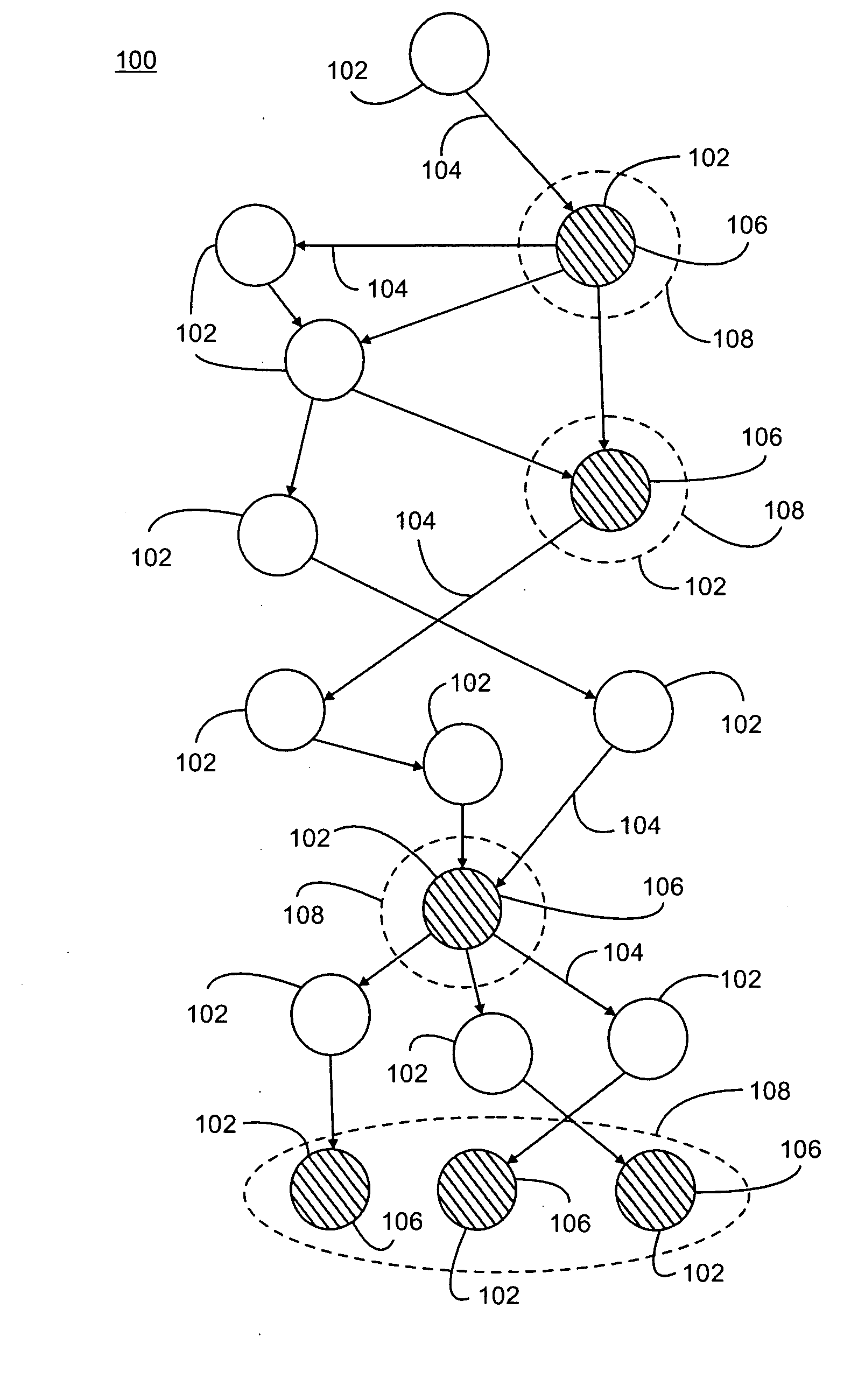

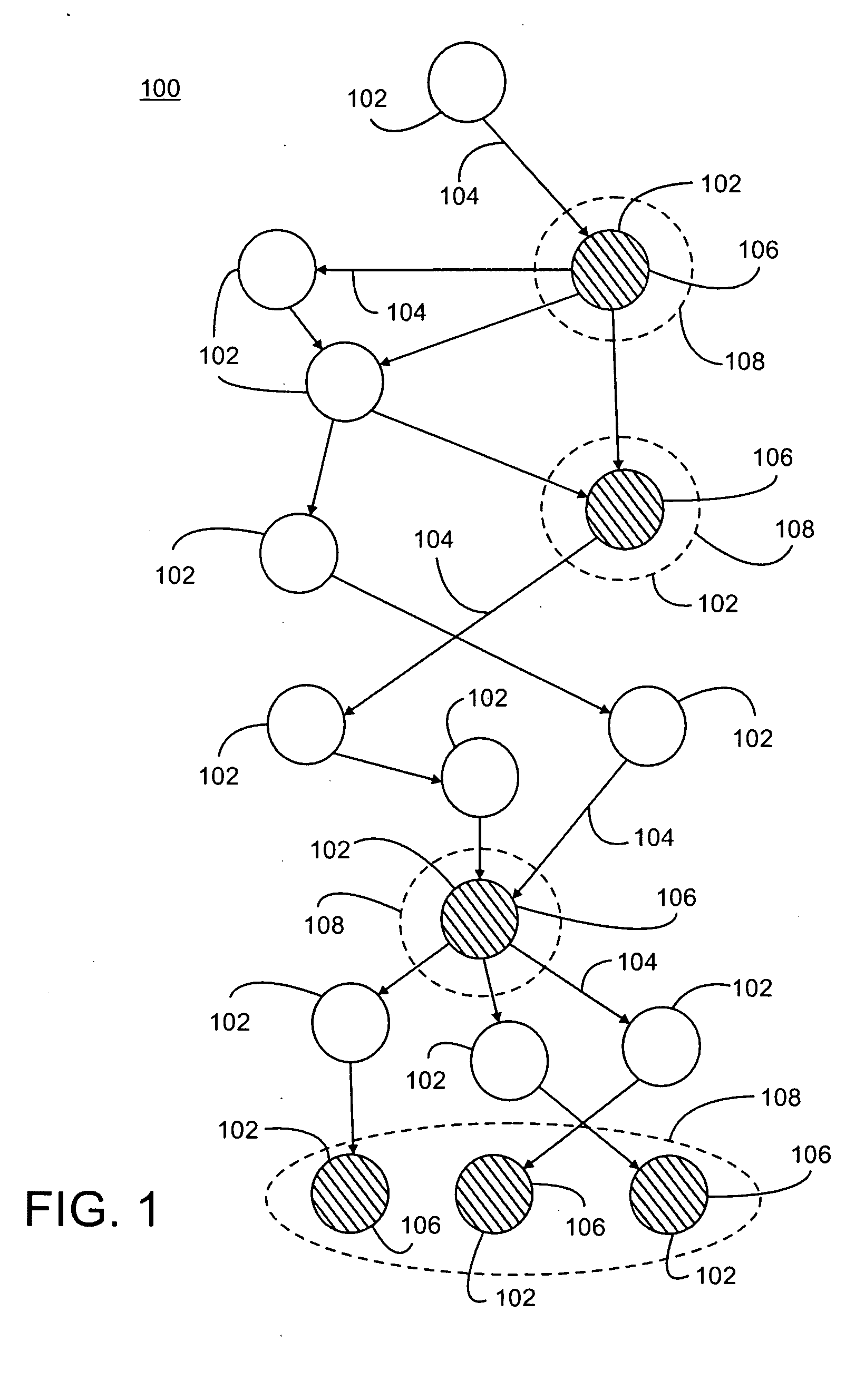

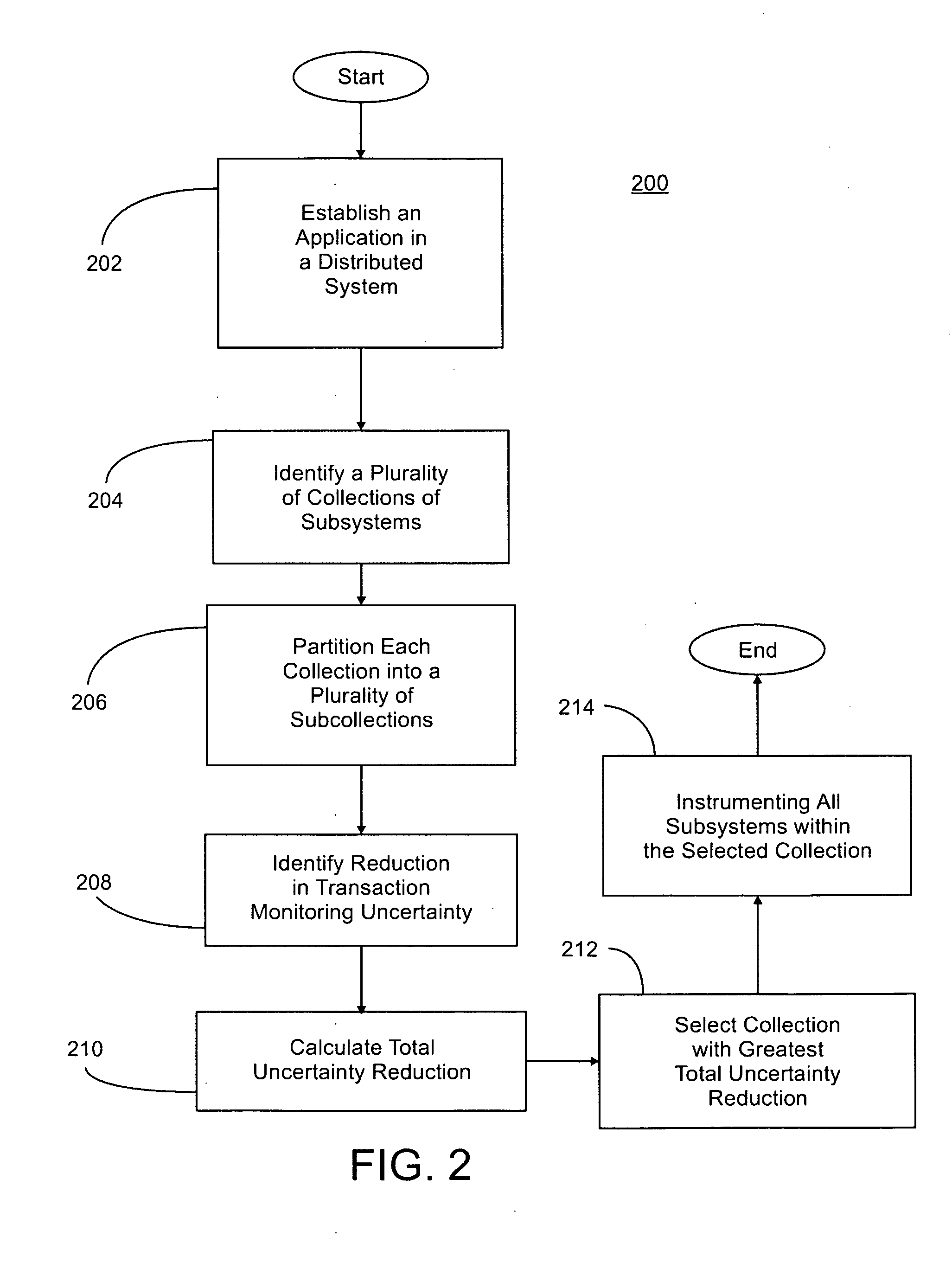

Selective Instrumentation of Distributed Applications for Transaction Monitoring

InactiveUS20100318648A1Improve monitoring accuracyAccelerating transactionDigital data processing detailsError detection/correctionMonitoring systemApplication software

Systems and methods provide a selective instrumentation strategy for monitoring the progress of transactions in a distributed computing system. The monitoring of the transactive processing of jobs is considered through a collection of computer operating stages in a distributed system, using limited information. The monitoring is performed by observing log records (or footprints) produced during each stage of processing in the system. The footprints lack unique transaction identifiers resulting in uncertainties in monitoring transaction instances. The processing stages are selective instrumented to reduce monitoring uncertainty under the given constraints such as limited budget for instrumentation cost.

Owner:IBM CORP

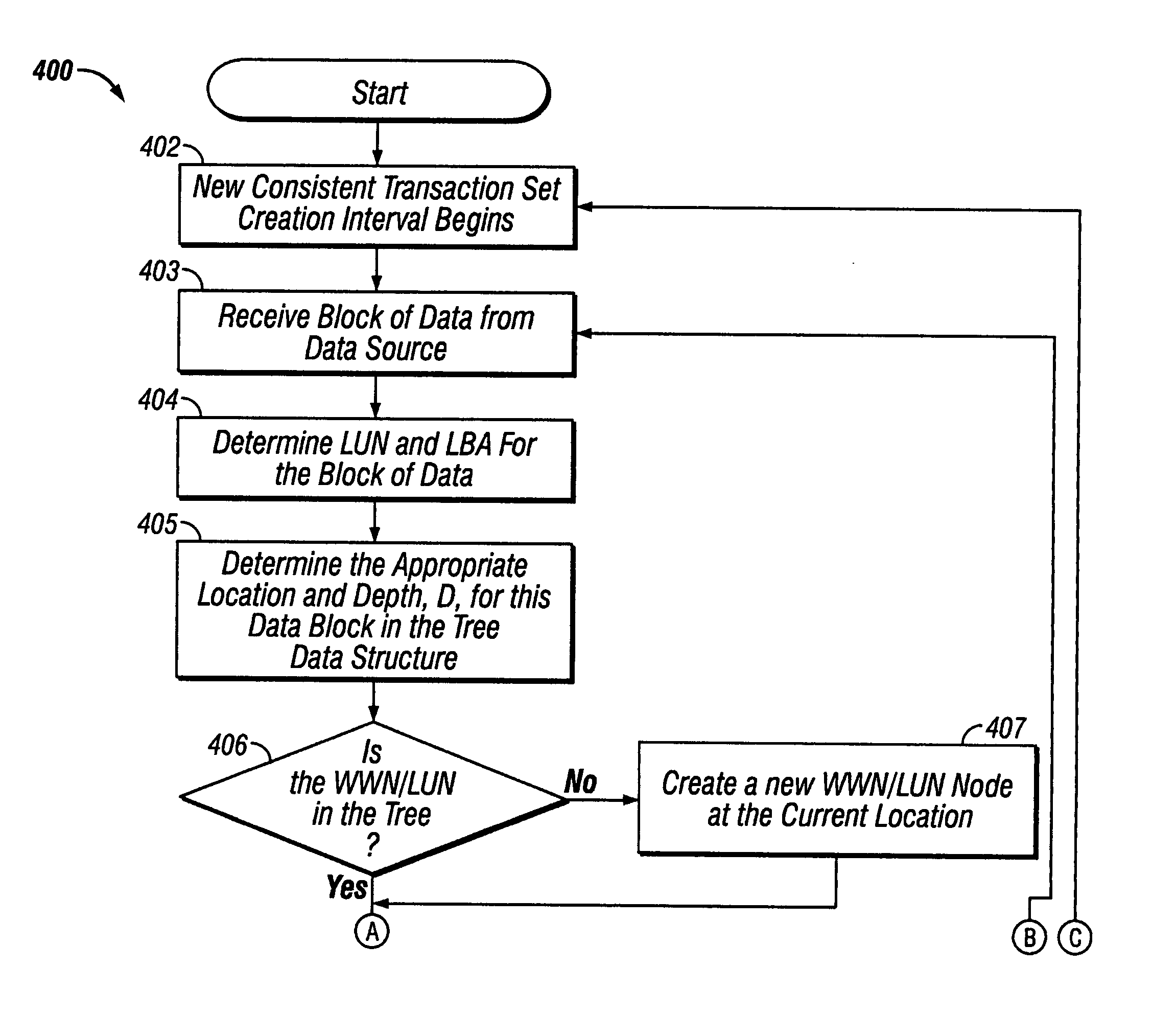

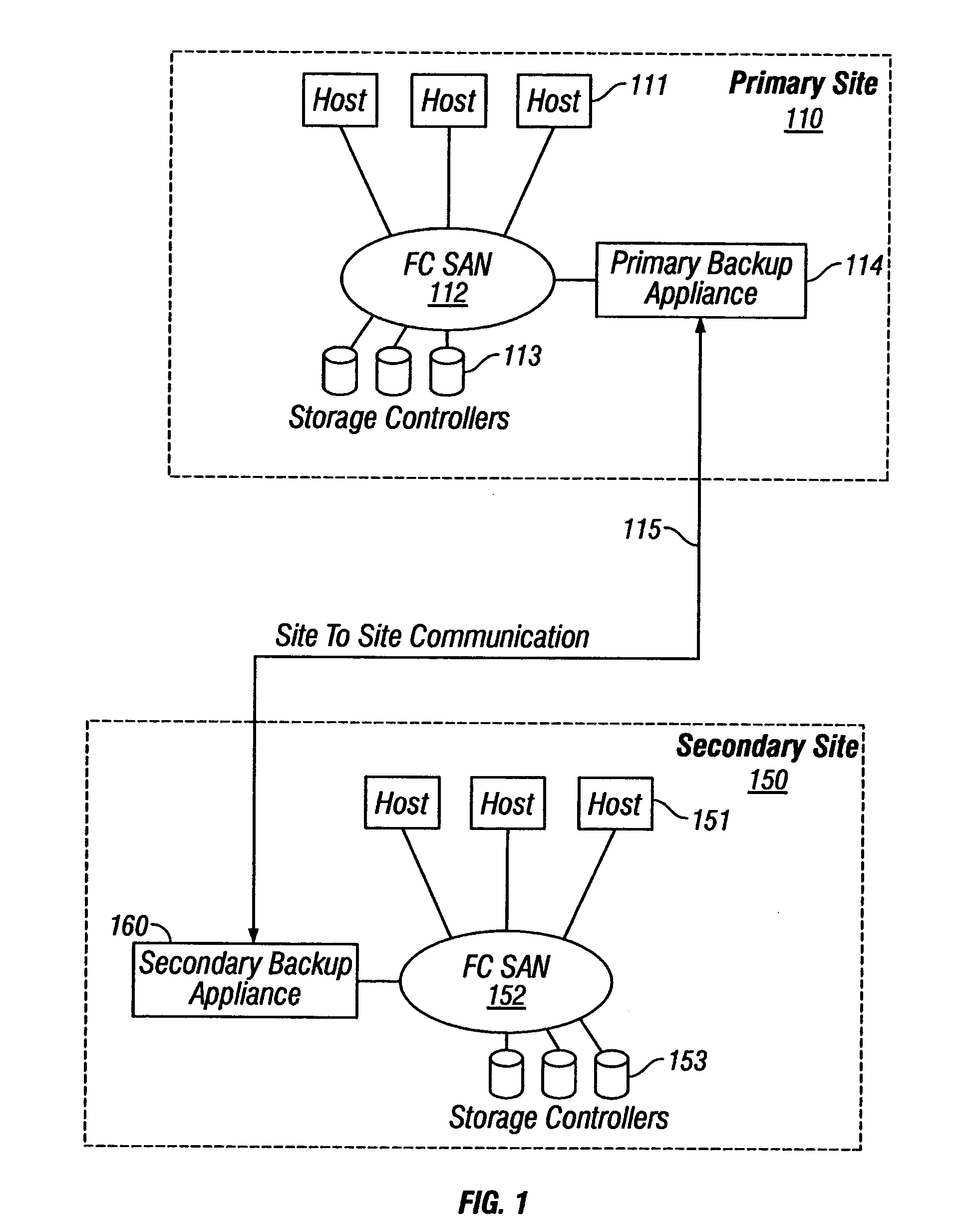

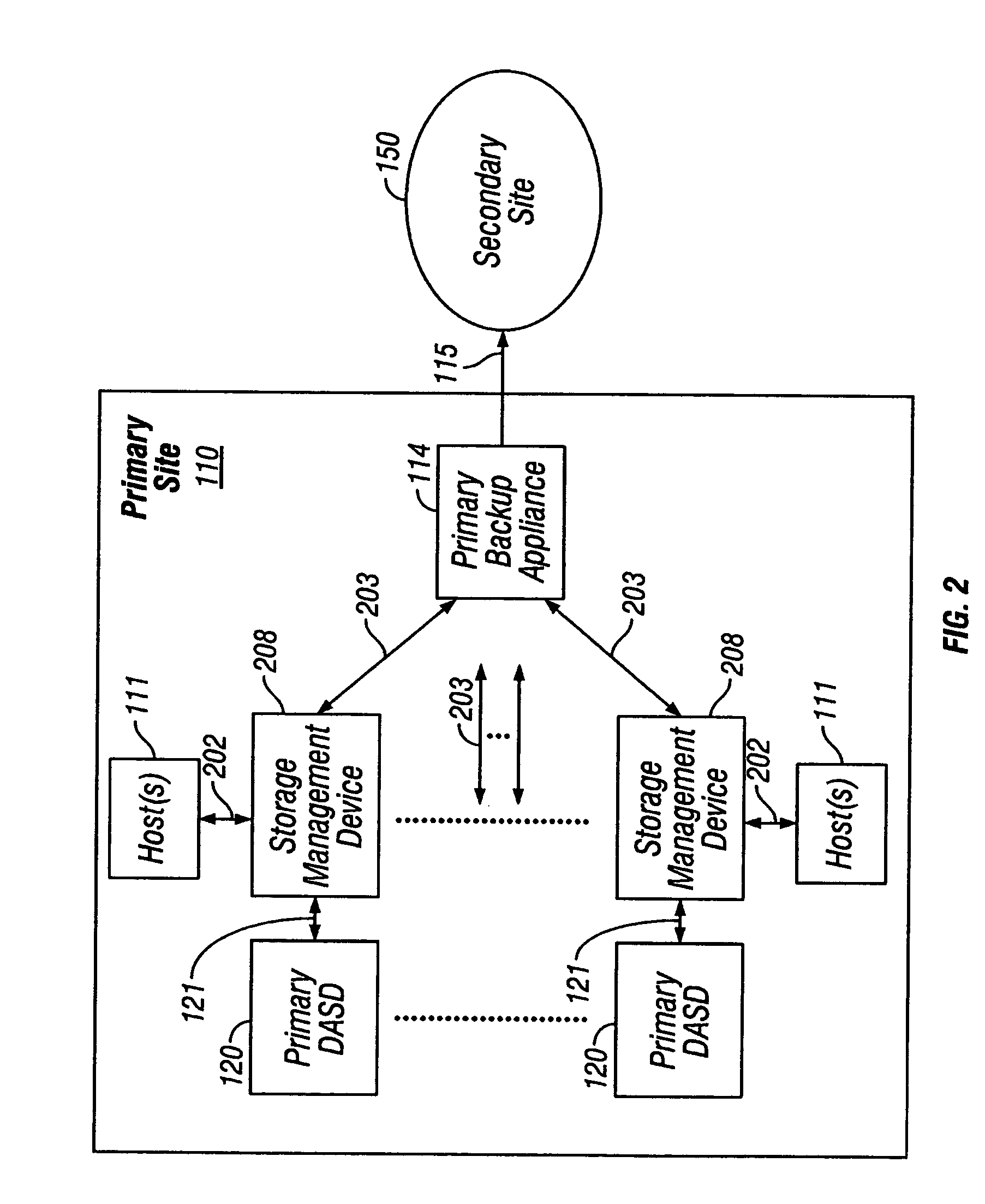

Autonomic link optimization through elimination of unnecessary transfers

InactiveUS20050010732A1Create efficientlyAccelerating transactionData processing applicationsMemory loss protectionPrimary sitesTree (data structure)

Disclosed are a system, a method, and a computer program product to efficiently create consistent transaction sets to maintain one or more copies of data at different data storage sites. All transactions sent to a primary backup appliance during a consistent transaction set creation interval are formed into a consistent transaction set by efficiently adding new transactions as they are received and removing unnecessary transfers as newer versions arrive. When the creation interval has expired, the complete consistent transaction set is transferred to a secondary backup appliance to be used to update a consistent backup copy of the primary site data. For each consistent transaction set, there will be a tree data structure (a search tree) created that contains the addressing information for all of the blocks of data in the consistent transaction set. The tree data structure used is a modified splay tree, which is a specialization of a binary search tree such that accessed nodes are “percolated” to the top of the tree for faster subsequent access. Secondary data consistency is maintained because the consistent transaction sets are applied whole at the secondary site, and after application, the secondary volumes are exact copies of the primary volumes at the time the consistent transaction set was completed.

Owner:IBM CORP

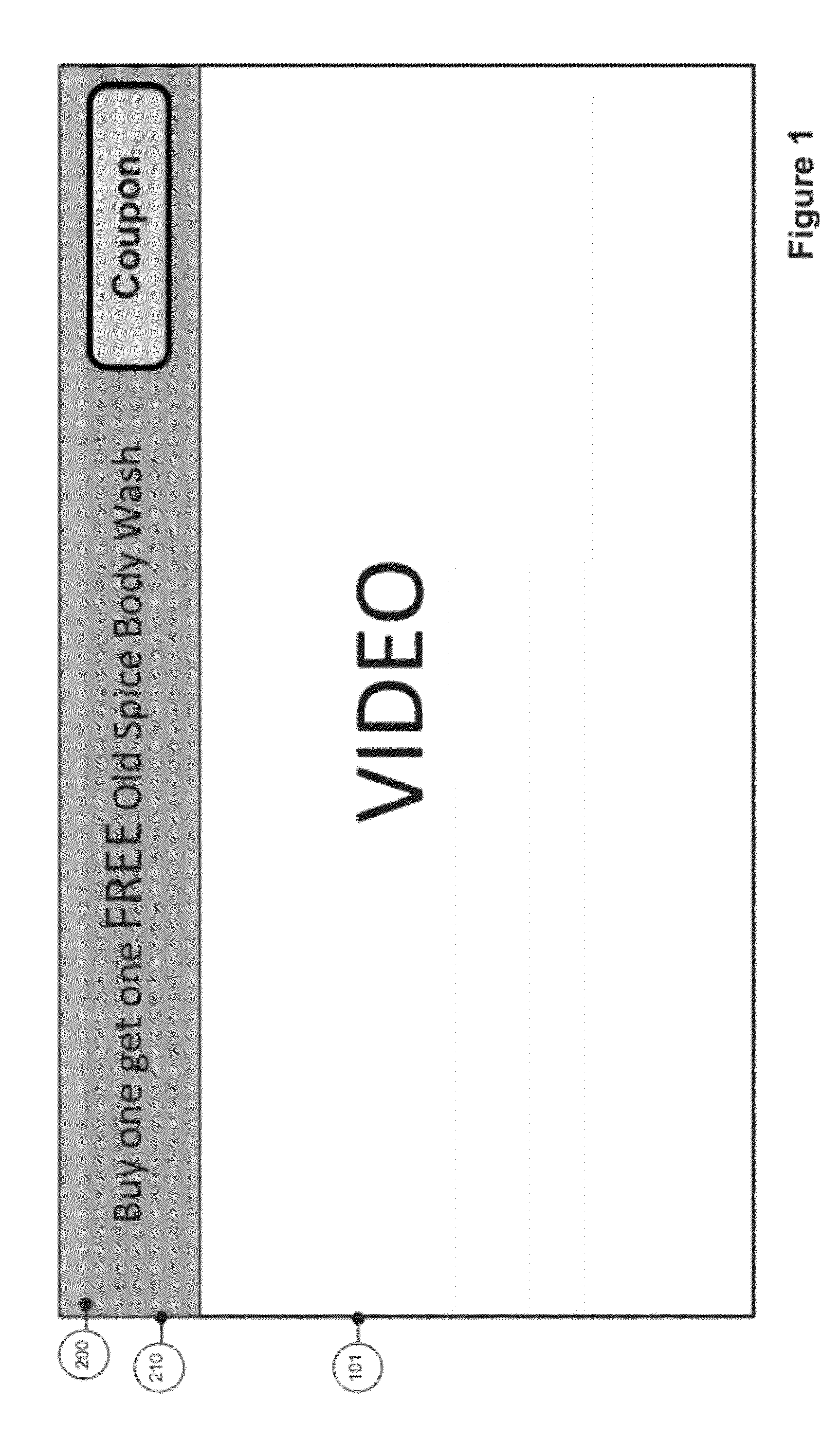

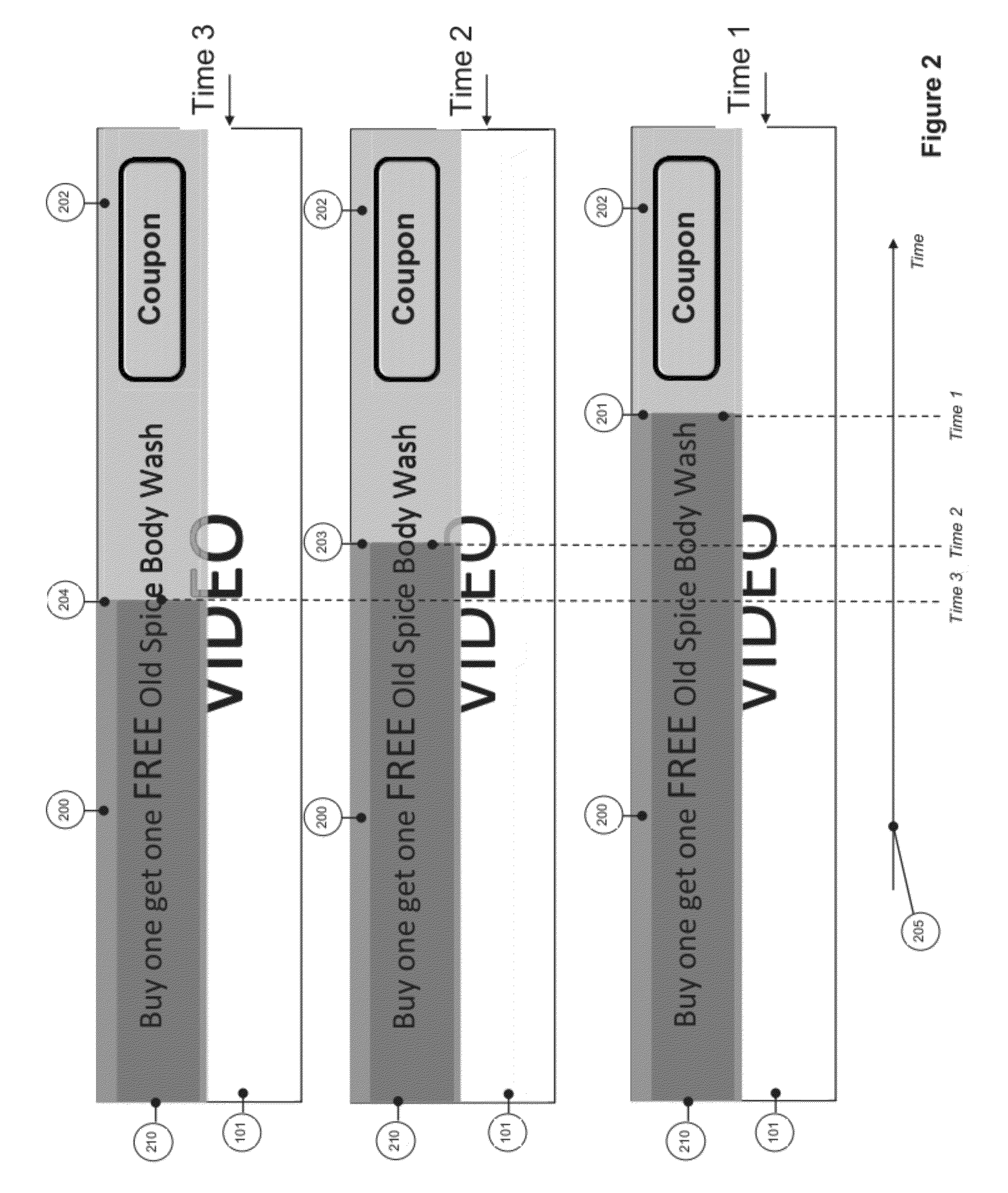

Video advertisement progress time indicator

InactiveUS20120307152A1Small sizeIncrease in sizeTelevision system detailsColor television detailsComputer graphics (images)

A method of indicating to a viewer the time remaining in a video advertisement, a system implementing the method, and a TV commercial are disclosed. The method comprises, on a processor, displaying a video advertisement, superimposing an indicator on the video advertisement, wherein the indicator bar has a first portion indicating the time remaining in the video advertisement and a second portion indicating the time that has elapsed in the video advertisement, and decreasing the size of the first portion and increasing the size of the second portion until the video advertisement is completed.

Owner:WEBTUNER CORP

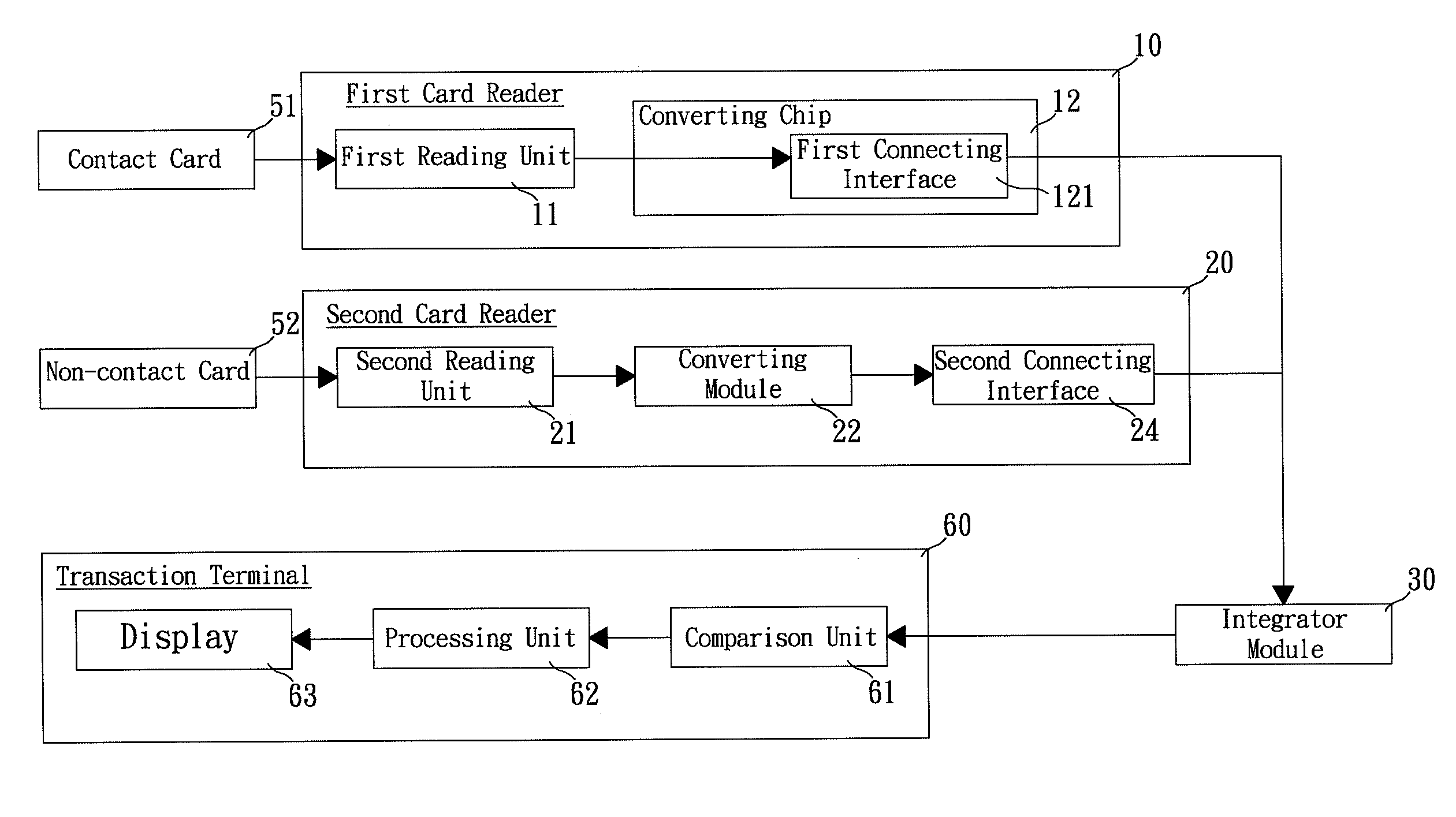

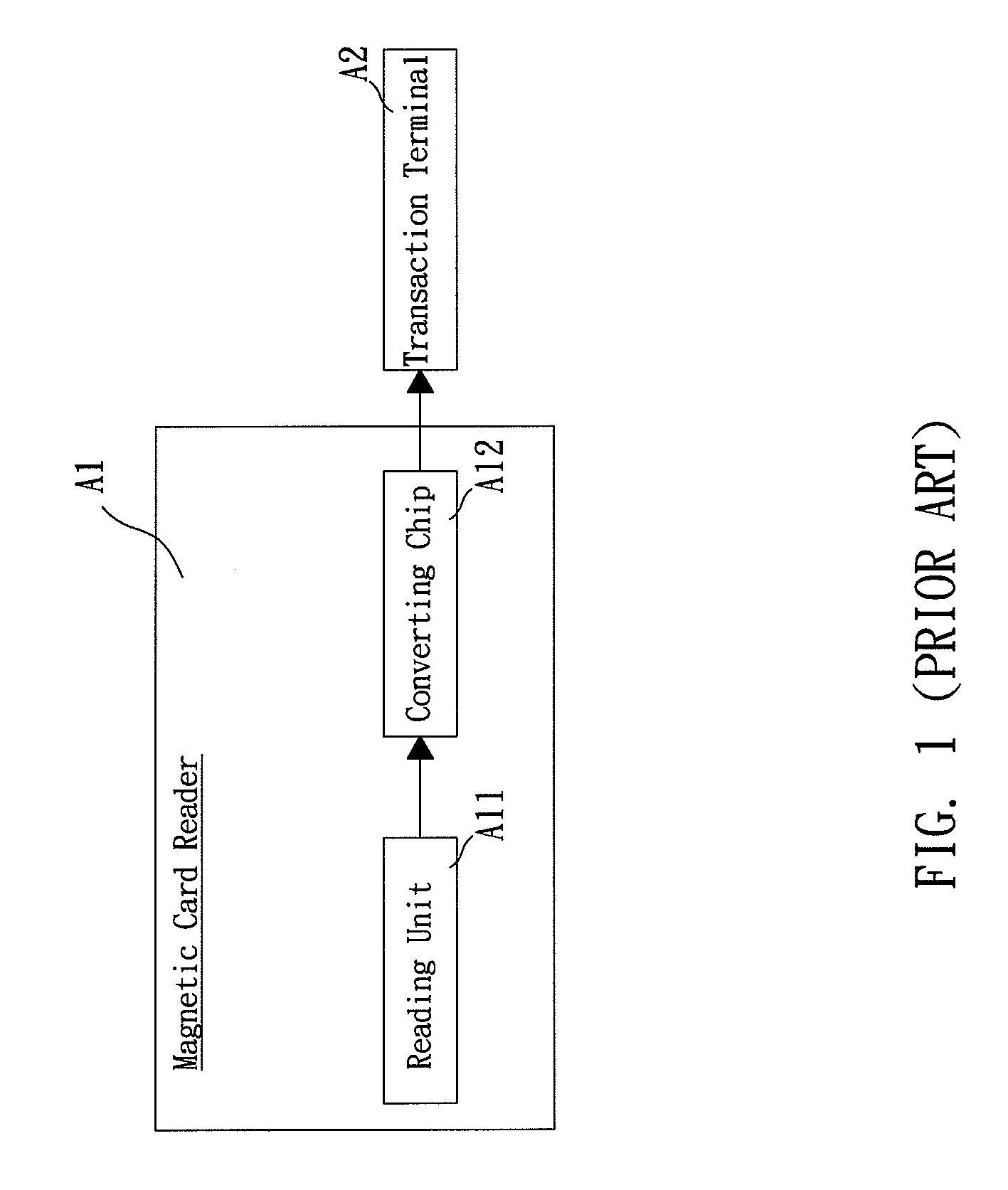

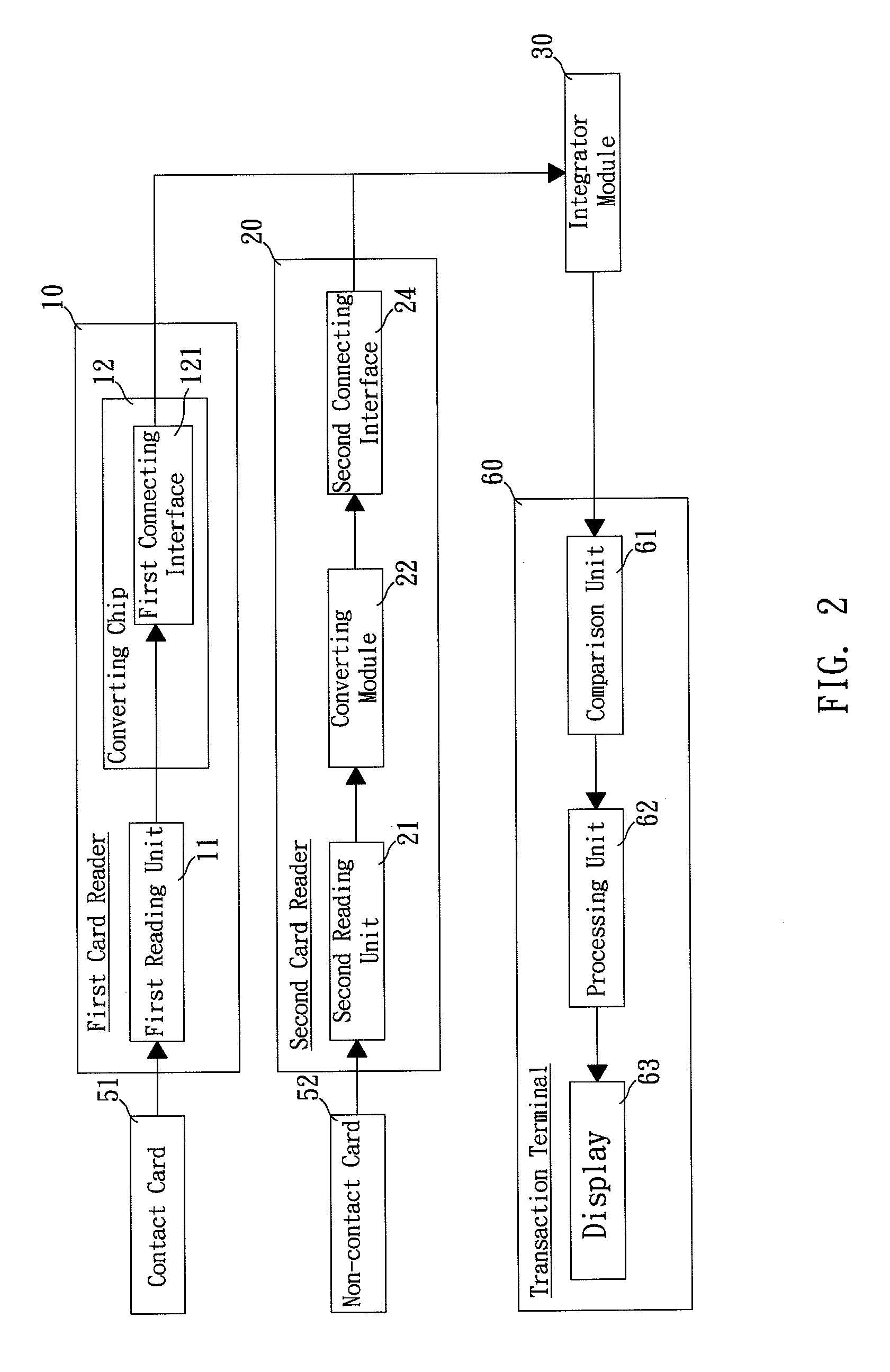

Card reading device for transaction system

InactiveUS20110068171A1Simplify the transaction processImprove user convenienceCo-operative working arrangementsHybrid readersElectricityIntegrator

A non-magnetic card reader, a magnetic card reader and a card transaction method are provided to selectively read a magnetic card and a non-magnetic card for identification of payment transaction at a transaction terminal. The non-magnetic card reader includes an integrator module electrically connecting to the magnetic card reader and the transaction terminal. Each of the non-magnetic card reader, the magnetic card reader and the transaction terminal has one or more physical connectors compatible with a magnetic-card communication protocol. A non-magnetic card signal incorporated with card data of the non-magnetic card is converted by the integrator module to match the magnetic-card communication protocol and is selectively transmitted to a main controller of the transaction terminal for identification. A magnetic card signal from the magnetic card reader incorporated with card data of the magnetic card is selectively transceived through the integrator module to the main controller for identification.

Owner:UNIFORM INDAL CORP

Automated banking machine that employs a virtual person for assisting customers

ActiveUS9098961B1Accelerating transactionResponses generated by the at least one computer may be made quicker and shorterComplete banking machinesFinanceDisplay deviceOutput device

In an example embodiment, an automated banking machine that includes a computer, a camera, a display and an audio output device and is operative to cause visual outputs through the display and audio outputs through the audio output device, which correspond to a simulated person. The camera is in operative connection with the computer, and provides camera data to the computer. The computer is responsive at least in part to the camera data to cause eyes of the output simulated person to be directed toward the eyes of the machine user.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

Transaction automation and archival system using electronic contract disclosure units

ActiveUS8531424B1Accelerating transactionEasy to useImage analysisFinanceElectronic contractsDisplay device

A system is provided for controlling, real-time logging, and archiving complex commercial transactions such as the purchase and financing of an automobile. An electronic contract disclosure unit or ECDU includes a digitizing display for imaging documents involved in the transaction and a digitizer for manual interaction with images on the display. A computer controls the transaction, and may for instance, control the order of presentation of documents to a vehicle purchaser, receive the purchaser's signature on the displayed documents when required, offer choices of various packages that can be accepted or declined by the purchaser, and insures that the entire transaction is carried out properly. The ECDU logs the transaction for future review and preferably records video and audio. Fingerprint readers allow participants to select between options by pressing their thumb or finger on the readers.

Owner:REYNOLDS AND REYNOLDS

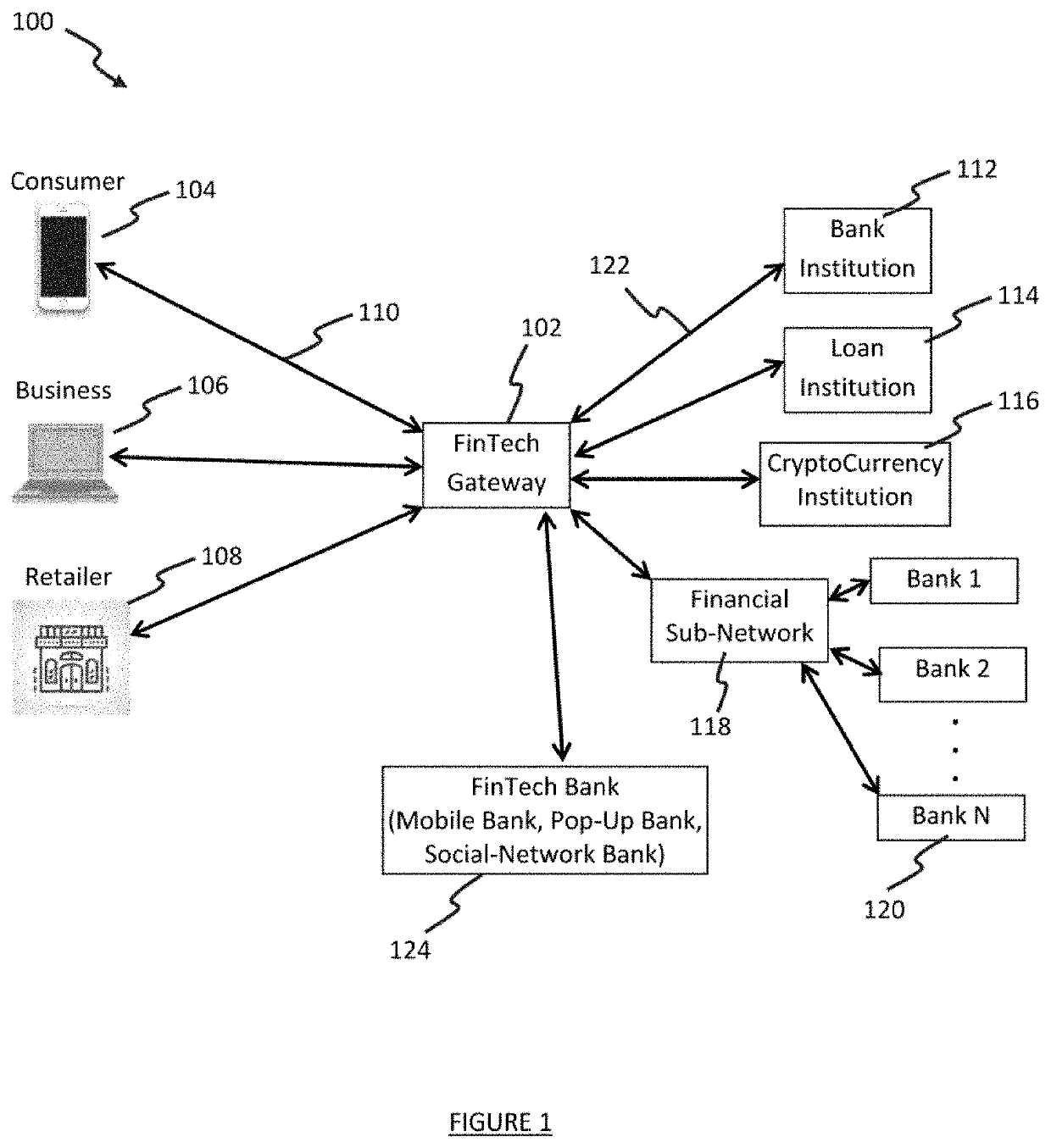

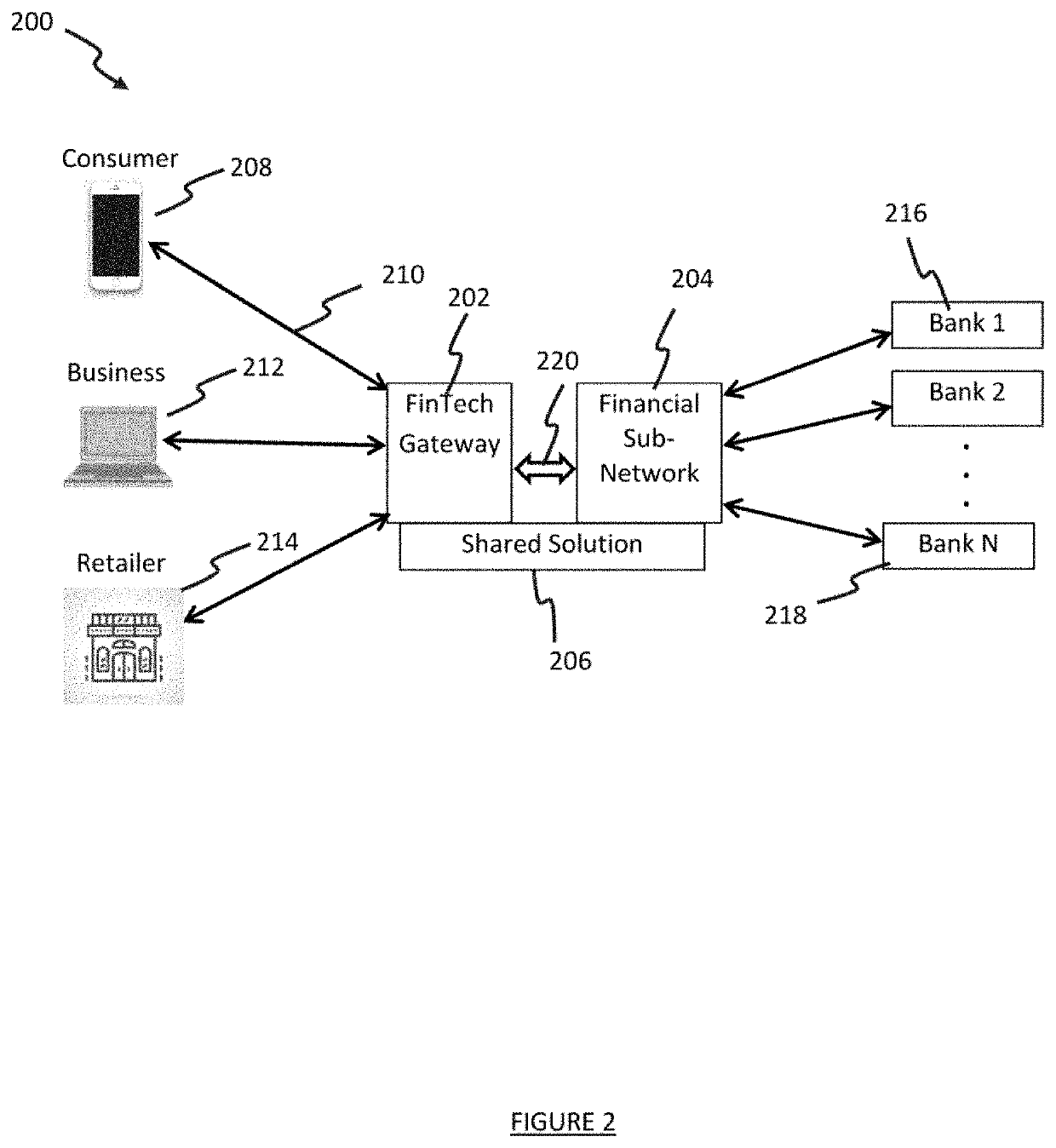

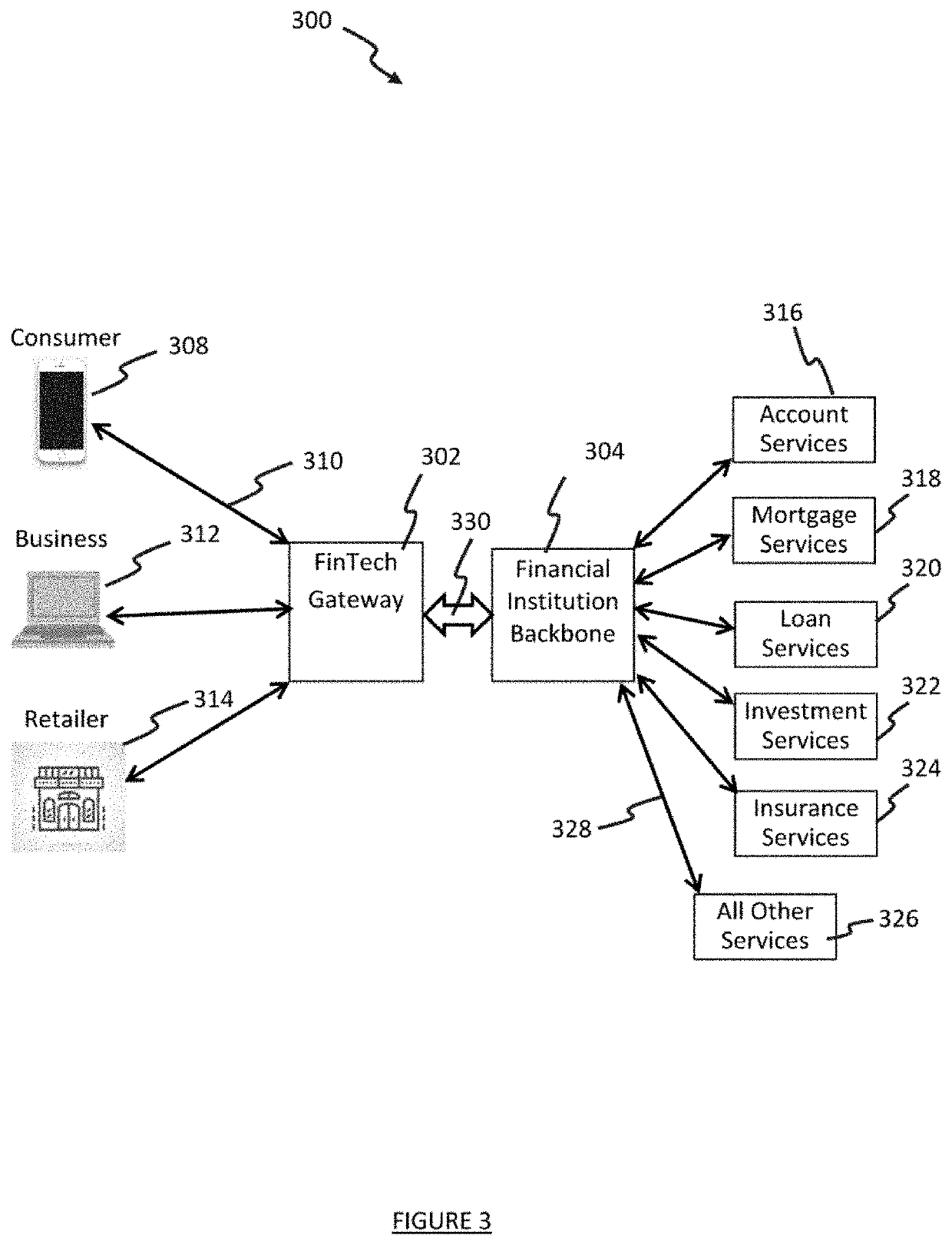

Computer systems, computer-implemented methods, and computer devices for processing a transaction message

PendingUS20200349639A1Improve transactionAccelerating transactionFinancePayment protocolsServices computingService provider

Systems, methods, and devices provide financial account services. The computer system provides financial services between one or more service requestor devices and one or more service provider devices. The computer system establishes links to one or more service provider devices by providing configuration to support the connection type, protocol and format of data exchanges with each of the service provider devices that have established links. The computer system authenticates each service provider device to establish trust for data exchanges. The computer system supports the reception of service requests from one or more service requestor devices. Then by using the configured link information, the computer system determines the type and format of service requests. The computer system transcodes the service request. The computer system permits the flow of service requests to two or more service provider devices when the configured link information are not similar.

Owner:10353744 CANADA LTD

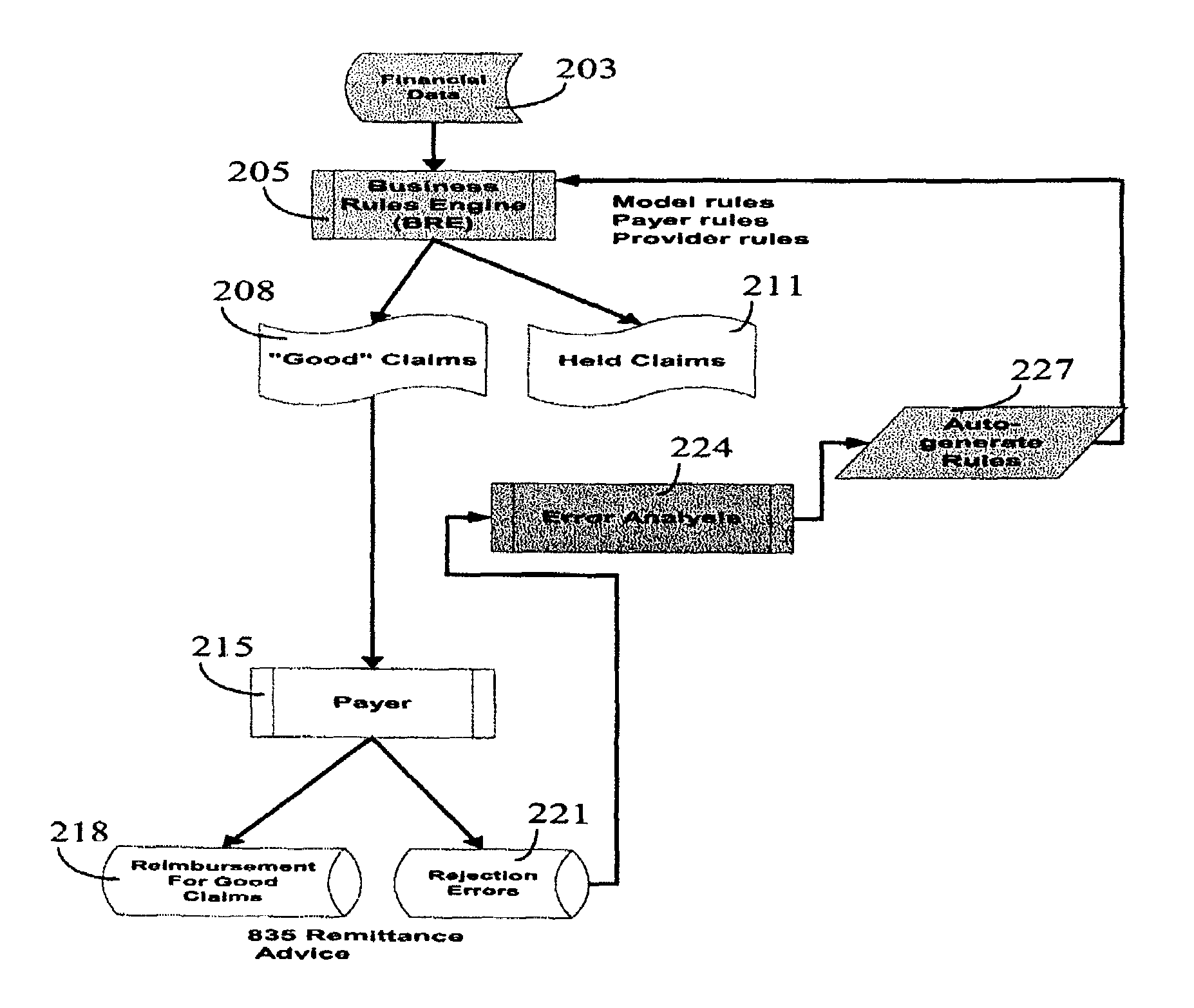

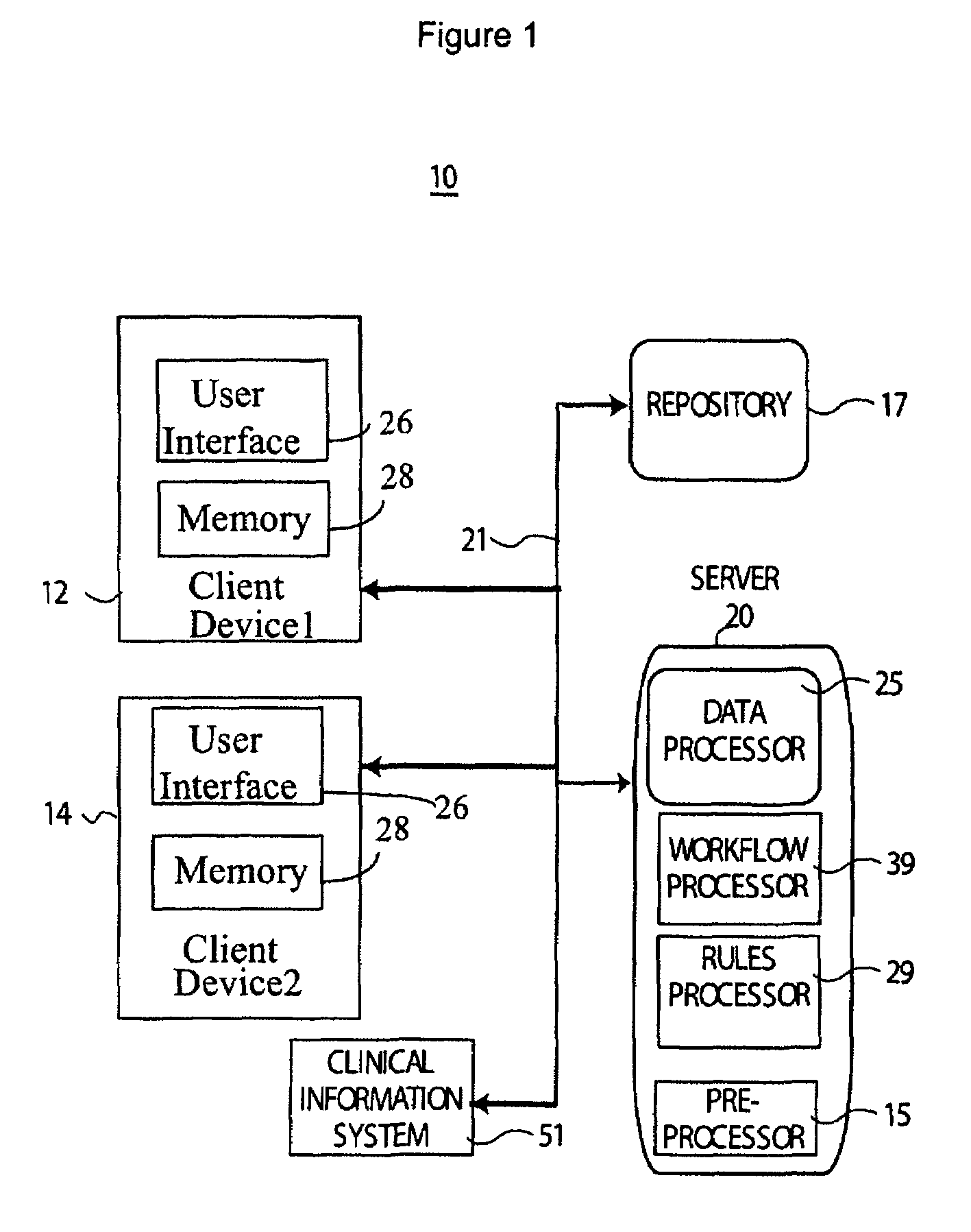

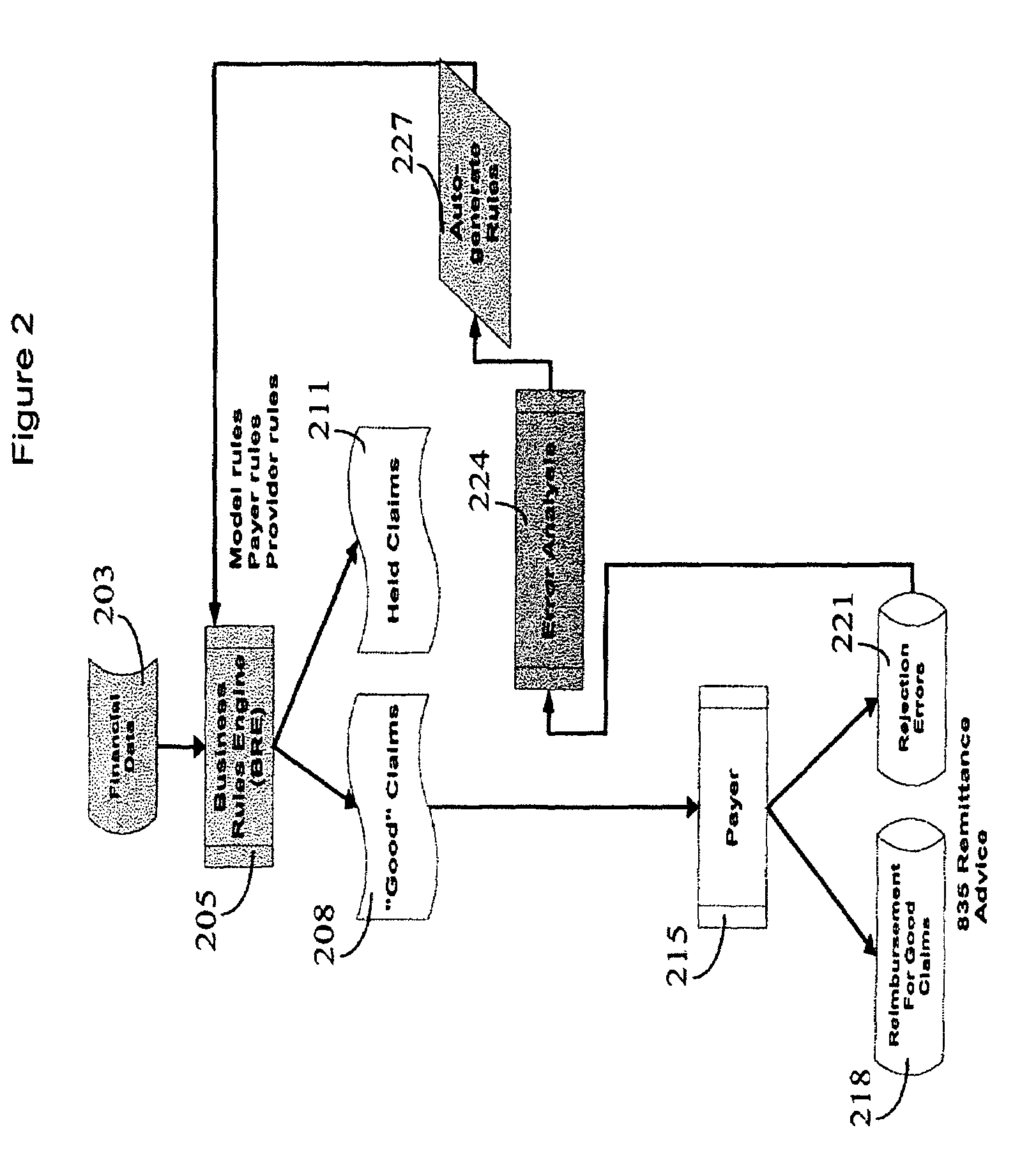

Adaptive system for financial claim reimbursement processing

A system improves payment claims transactions by analyzing payments transactions to update payment edit rules according to information derived from the transactions. A system adapts rules used for processing claim adjudication data provided by a payer organization concerning a claim for reimbursement for provision of healthcare to a patient previously submitted to the payer organization in a claim. The system includes a data processor for parsing claim adjudication data provided by a specific payer organization in an electronic transaction message to identify data comprising, (a) a payer organization identifier and (b) a reason for rejection of a claim. A rules processor automatically generates a payer specific rule for use in pre-processing a claim for submission to the specific payer identified by the payer organization identifier by translating data comprising the reason for rejection into a logical expression resolvable using data elements in a claim. A rules repository accumulates data representing automatically generated payer specific rules for pre-processing a claim for submission to the specific payer.

Owner:CERNER INNOVATION

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com