Patents

Literature

1150 results about "Data provider" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

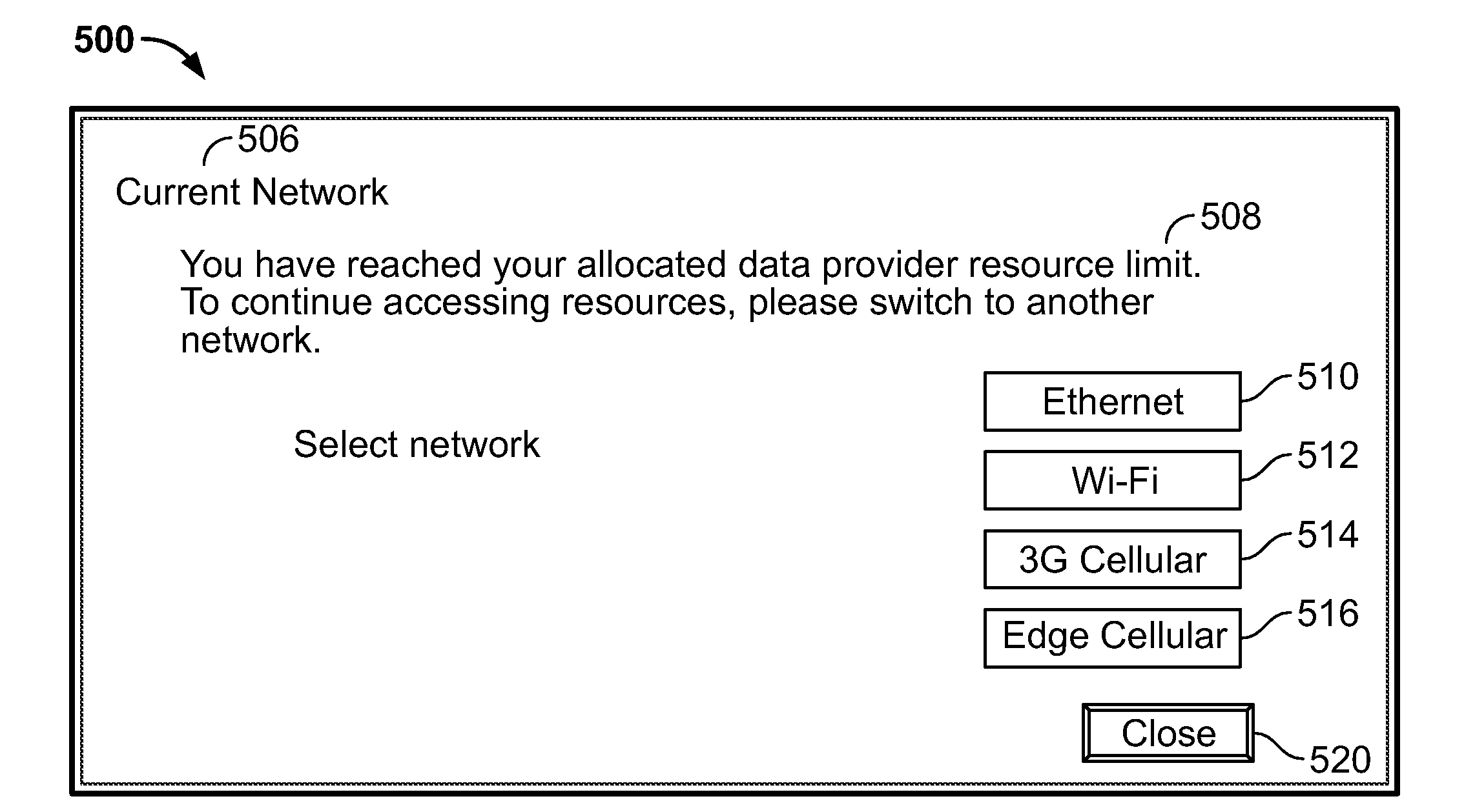

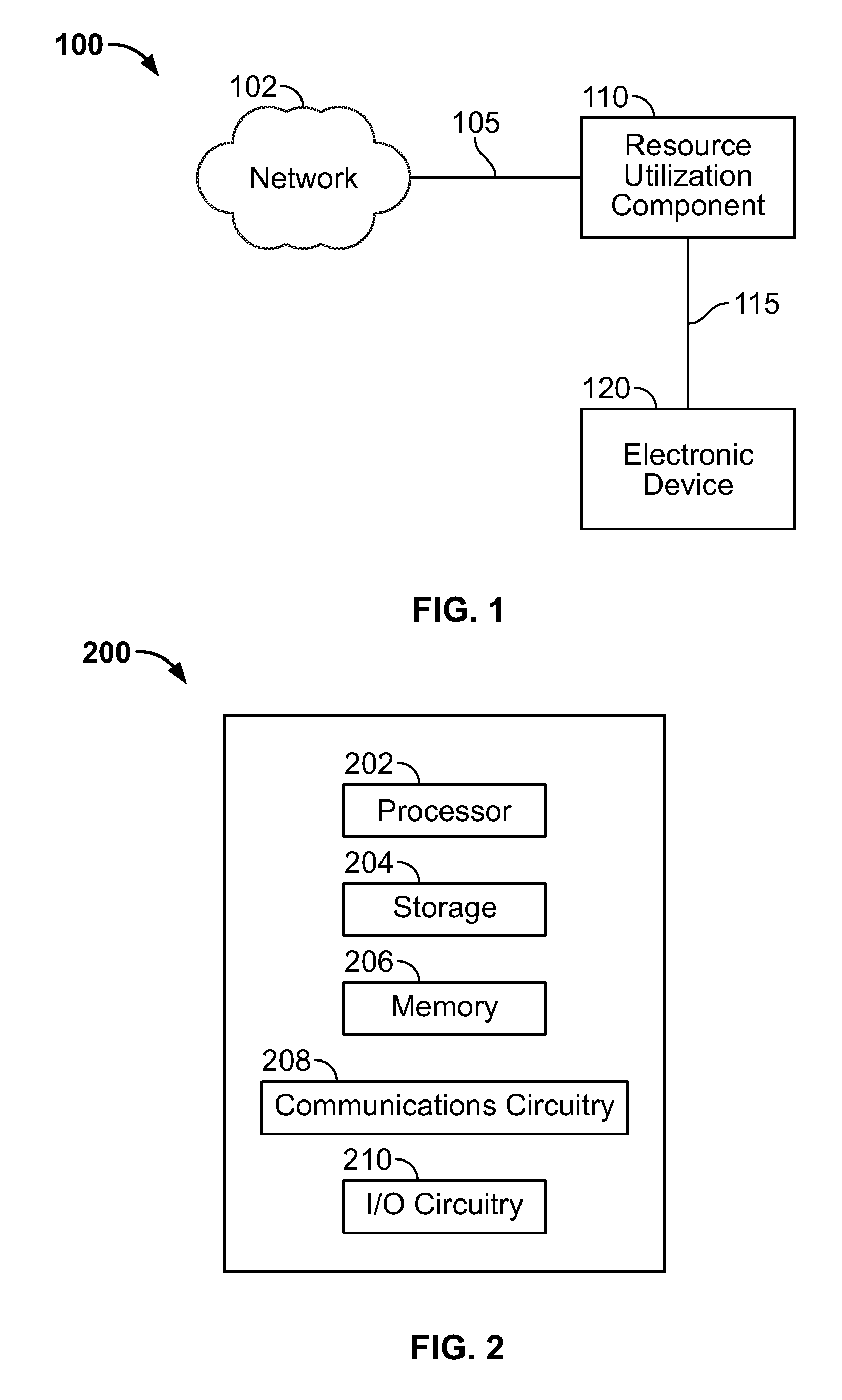

Systems and methods for monitoring data and bandwidth usage

ActiveUS20100017506A1Assess restrictionMultiple digital computer combinationsResource consumptionResource utilization

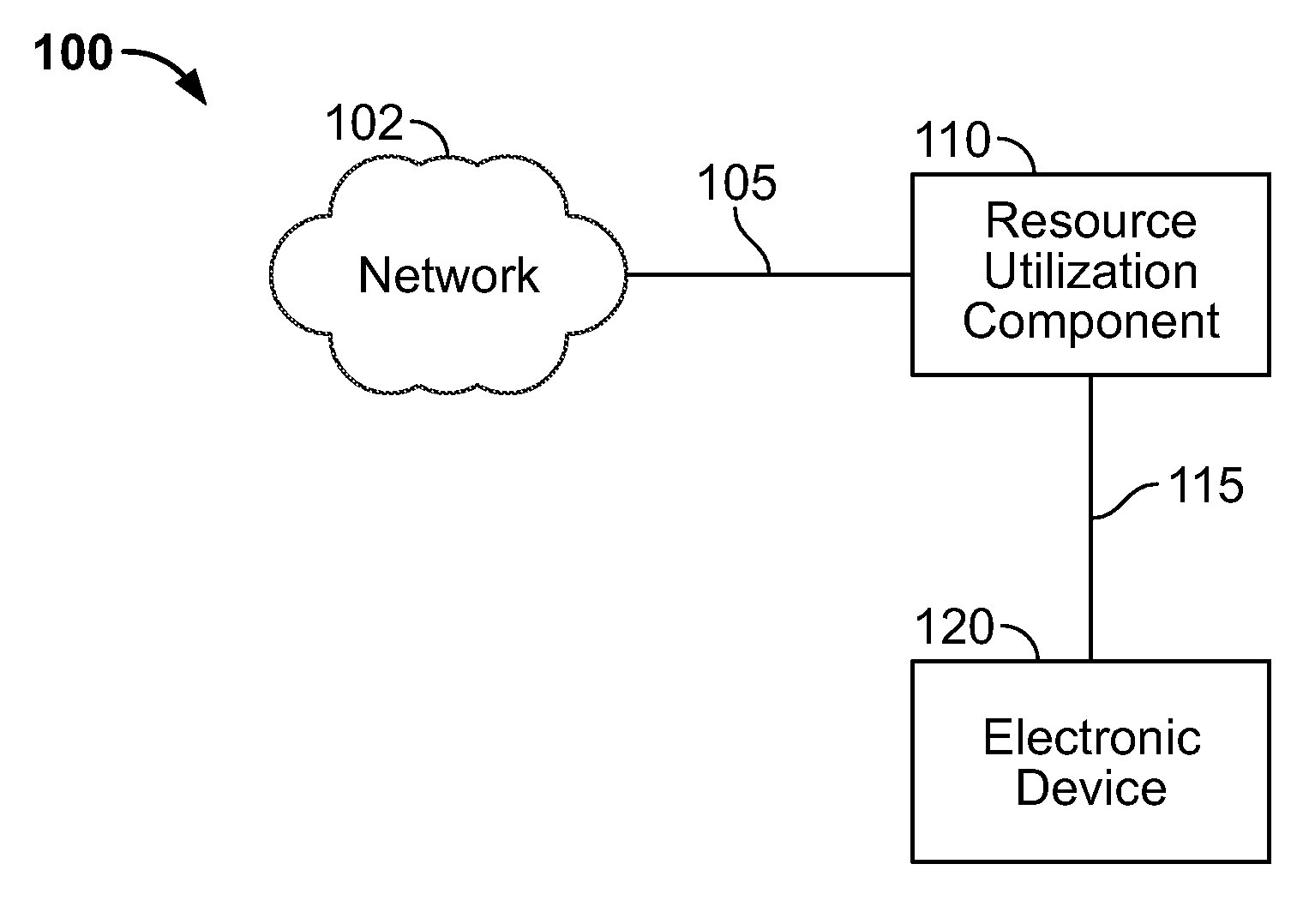

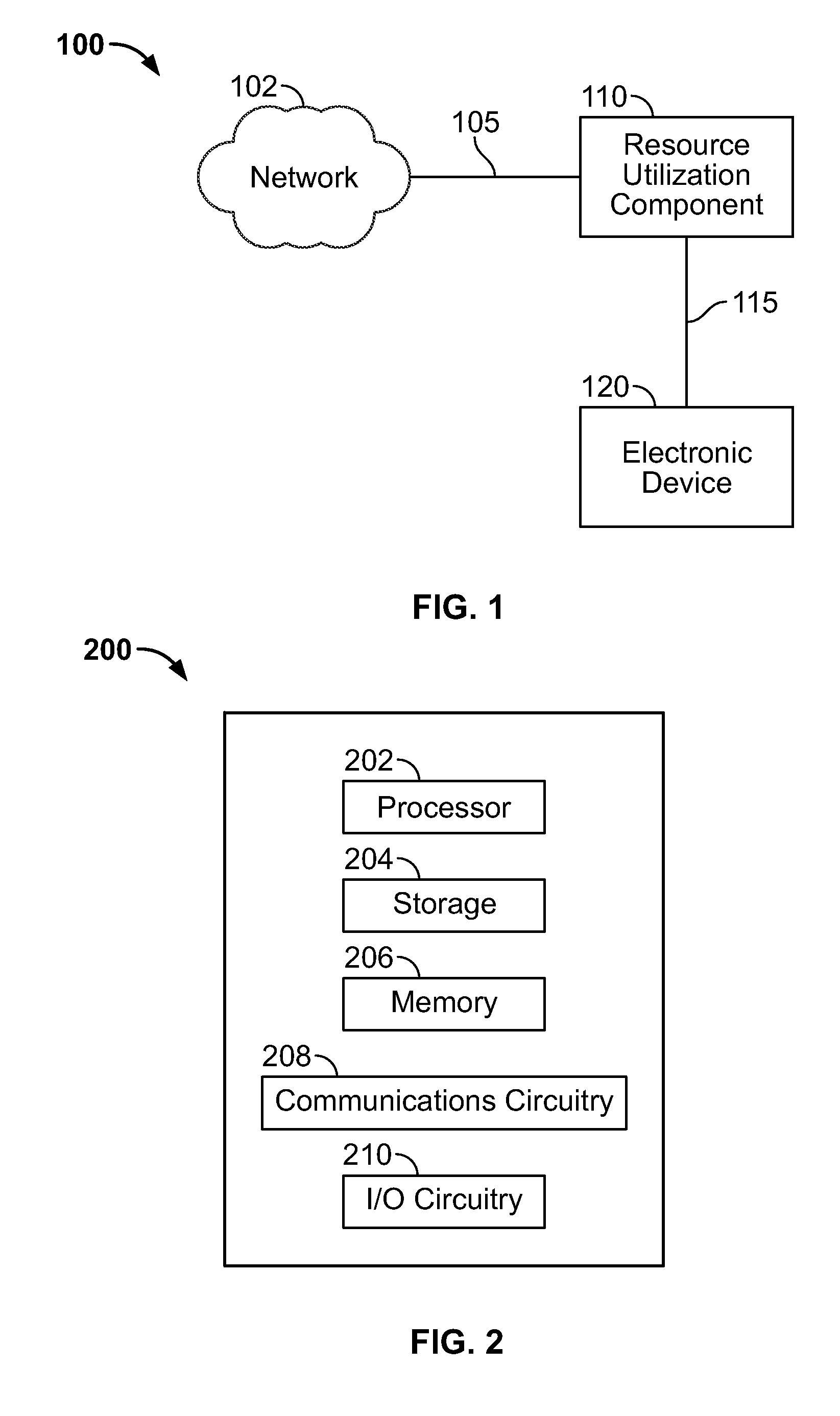

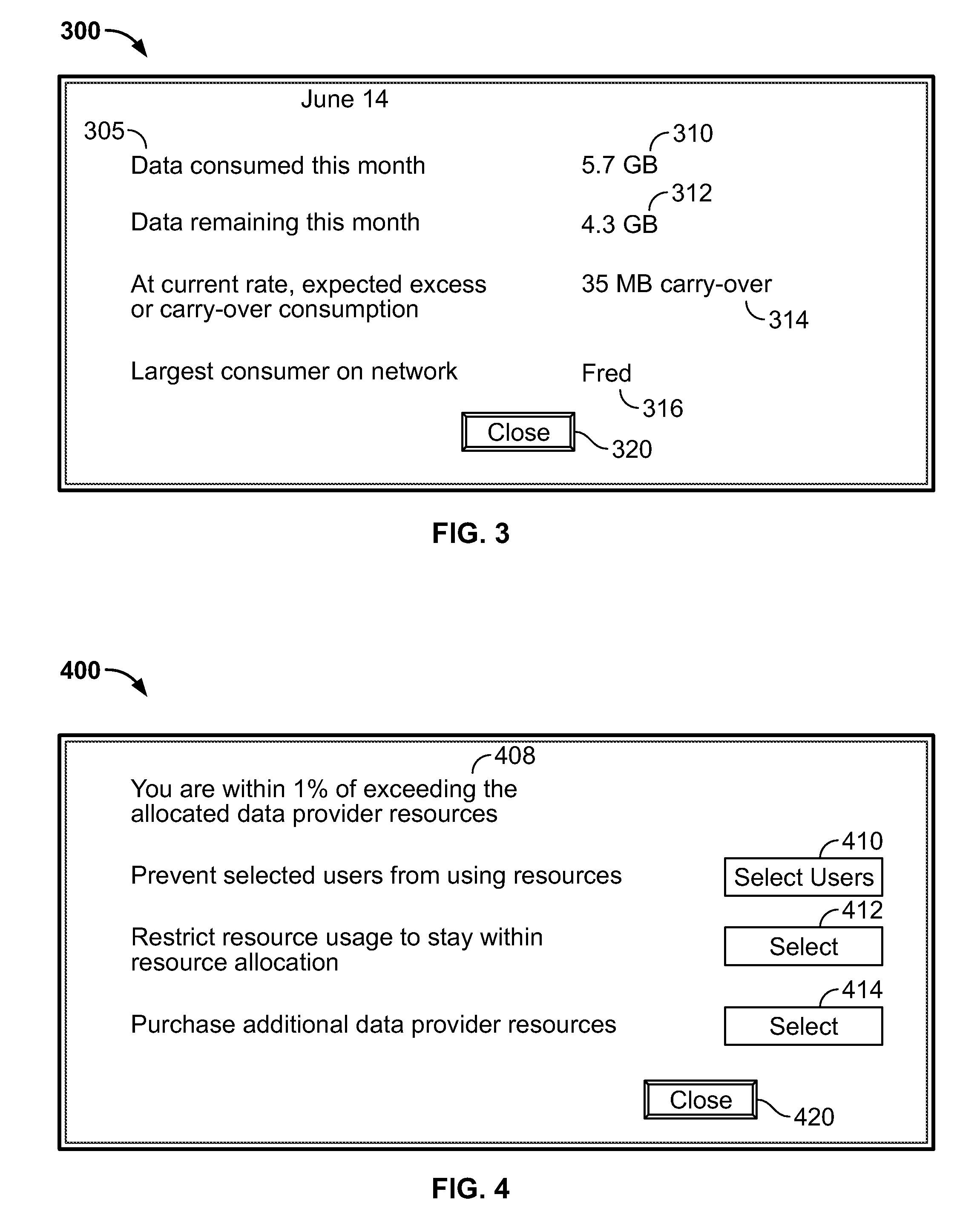

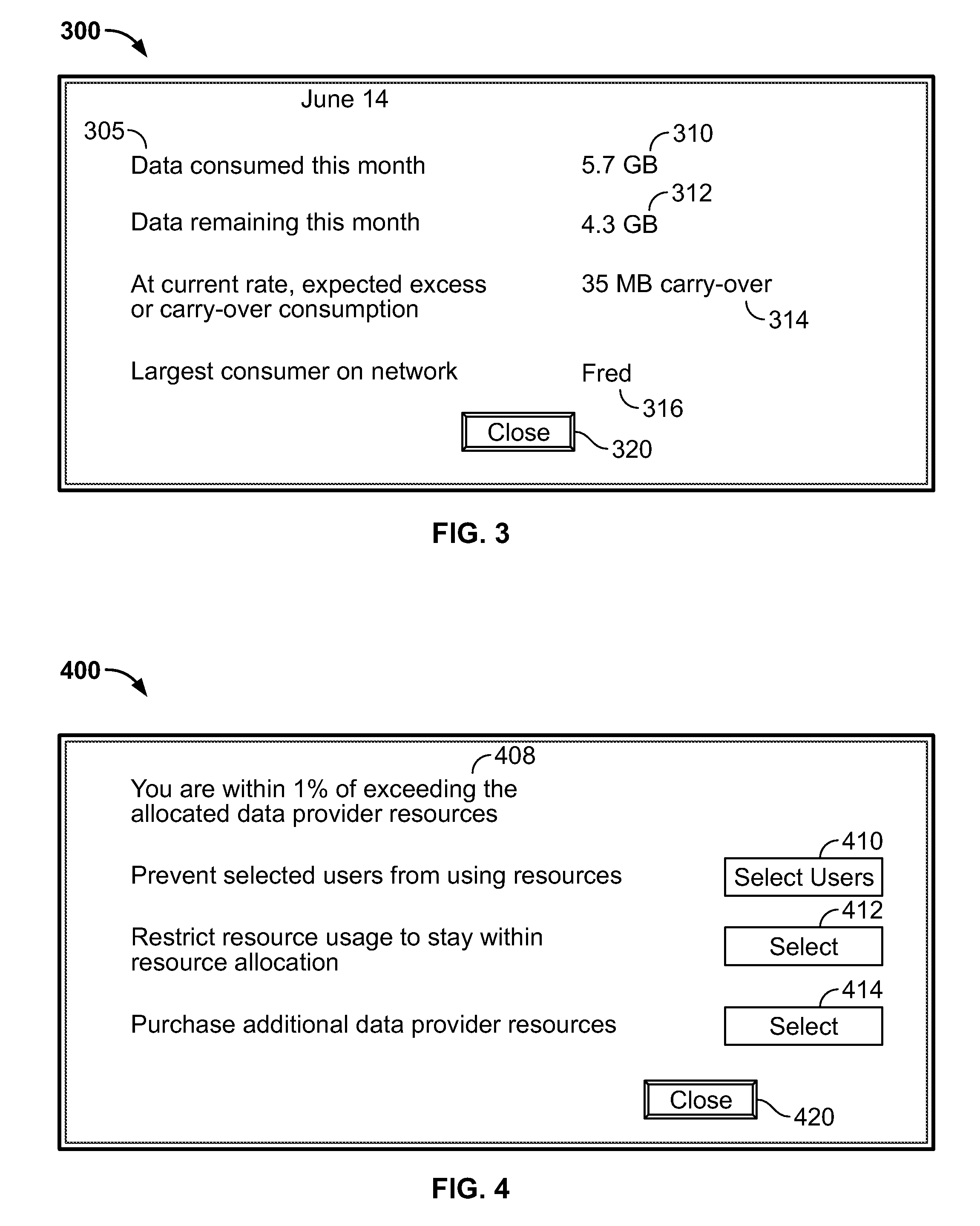

Access to a communications network may be provided via a data provider that may charge for access. In some cases, the access fee may be related to the amount of network resources consumed (e.g., amount of data downloaded or bandwidth used). In some cases, a user may have access to a particular amount of data provider resources and be required to pay an additional fee for using resources in excess of the particular amount. To assist the user in managing his data resource consumption, a resource utilization component may provide different alerts and notices informing the user of current consumption, expected future consumption, and recommendations for reducing data provider resources consumed (e.g., stopping particular processes or data provider requests, such as downloading media). If several electronic devices in a network are connected to the same data provider resources, a network component may manage the data provider resource use among the several electronic devices (e.g., allow only particular users or devices access).

Owner:APPLE INC

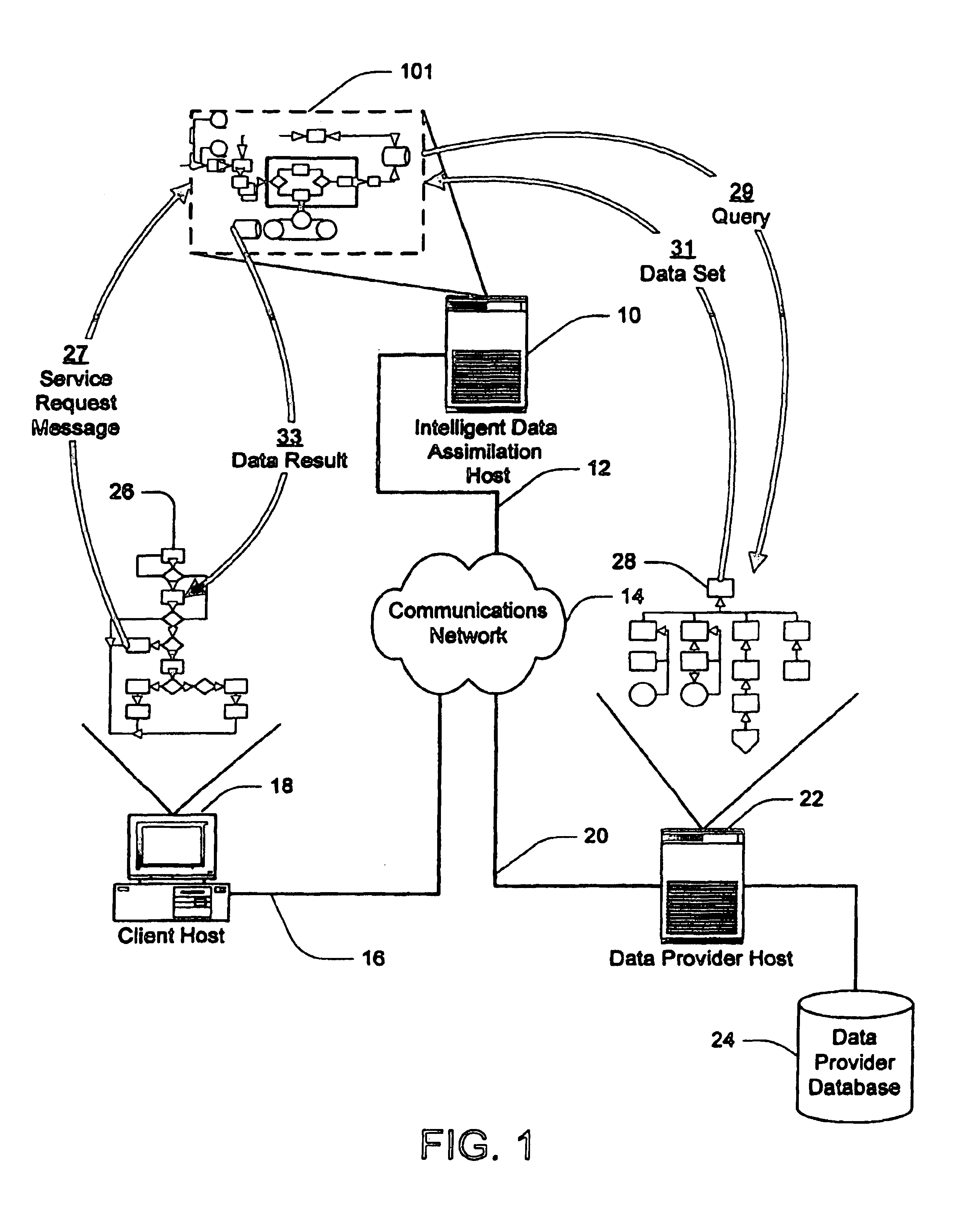

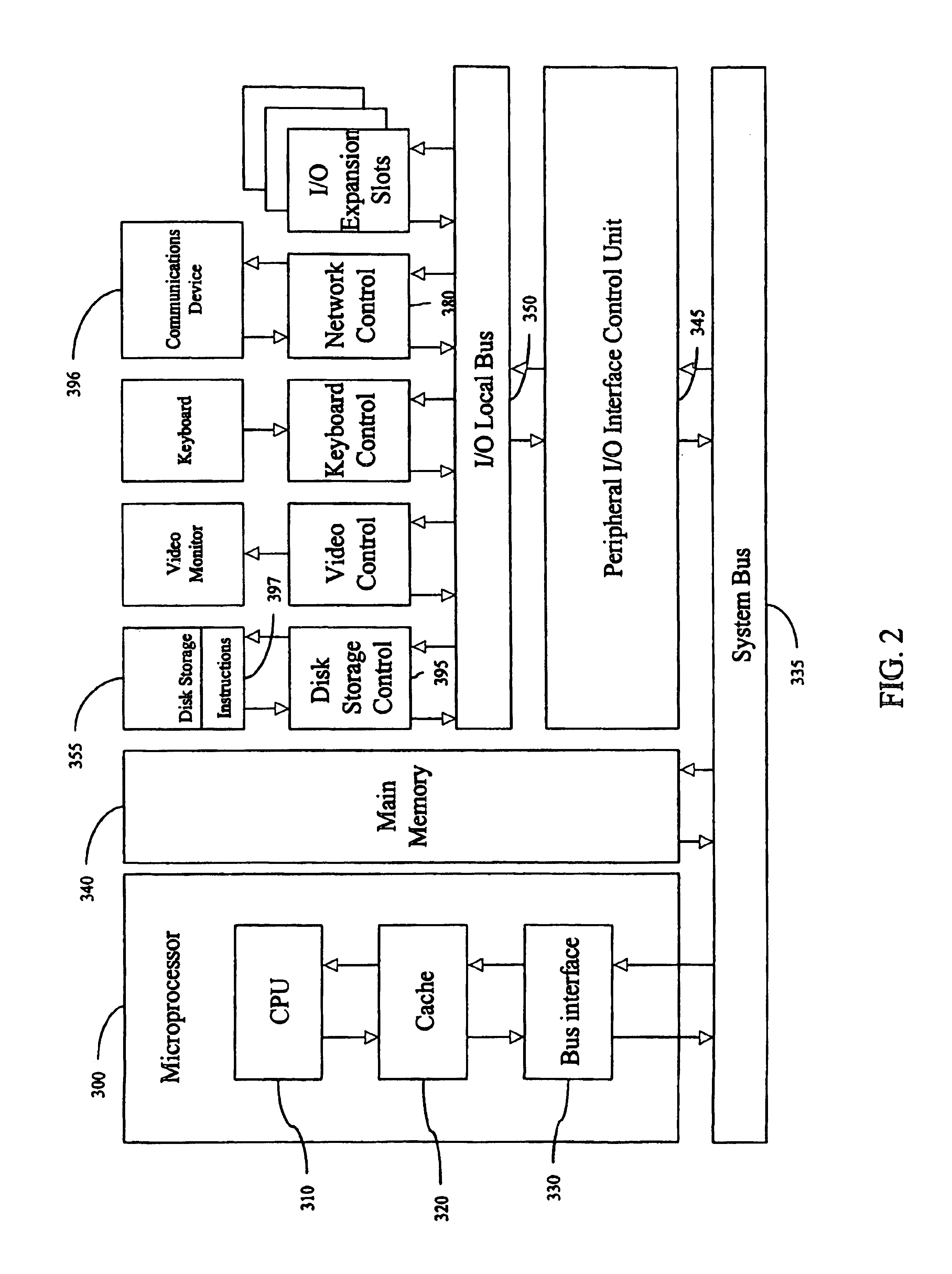

Method and apparatus for intelligent data assimilation

InactiveUS6847974B2Data processing applicationsWebsite content managementGraphical user interfaceApplication server

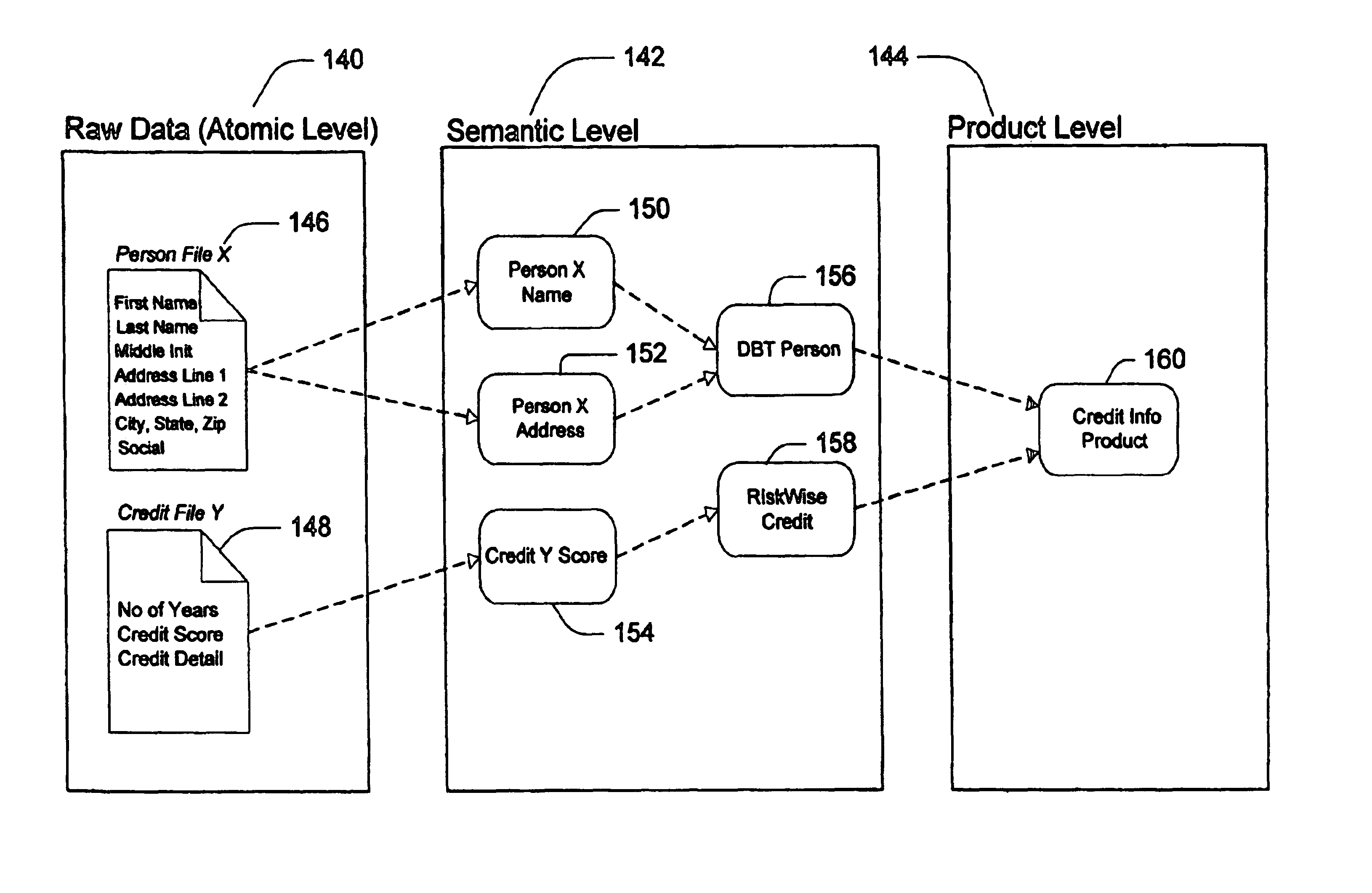

An intelligent data assimilation system including an ontology description, workflows, and logical search objects. The logical search objects operably connect to external and internal data providers and return search results using an ontology describing atomic data objects and semantic objects. The semantic objects are grouped into larger semantic structures by workflows to create customized services that return search results termed data products. Services are accessed through an application server capable of responding to service requests from different types of data clients. Graphical user interfaces provide facilities for creating logical search objects and aggregating logical search objects into workflows and services.

Owner:US SEARCH COM

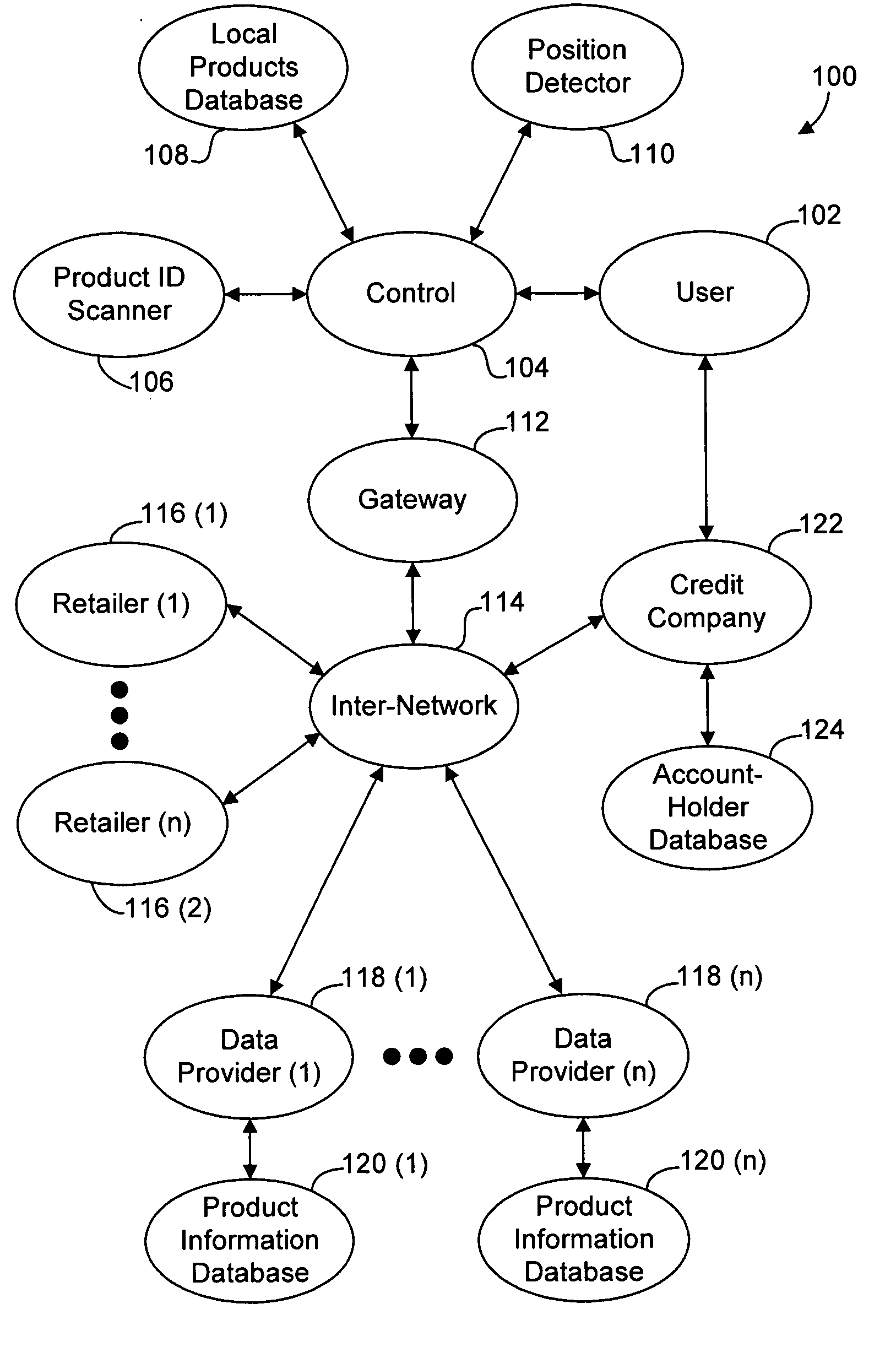

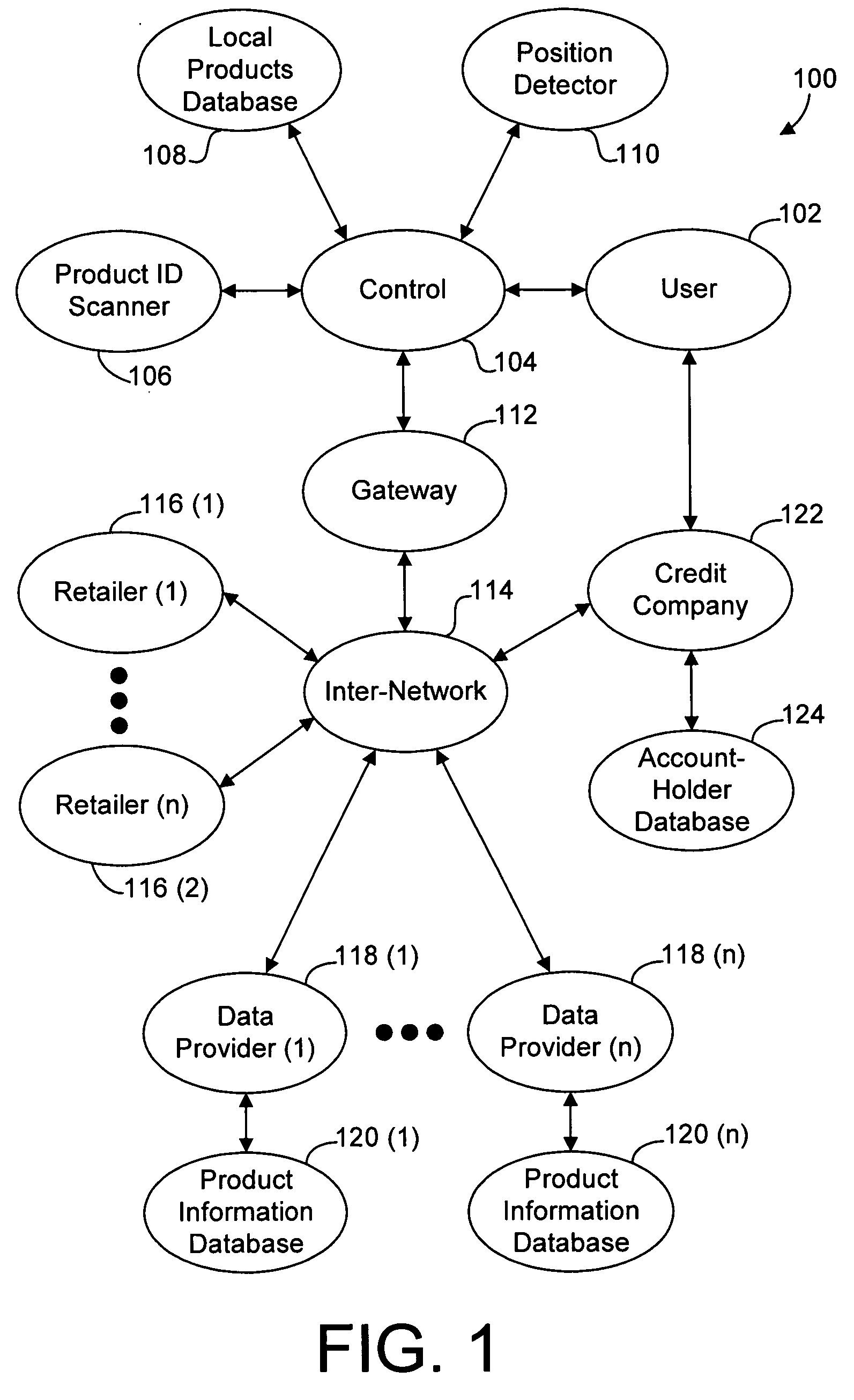

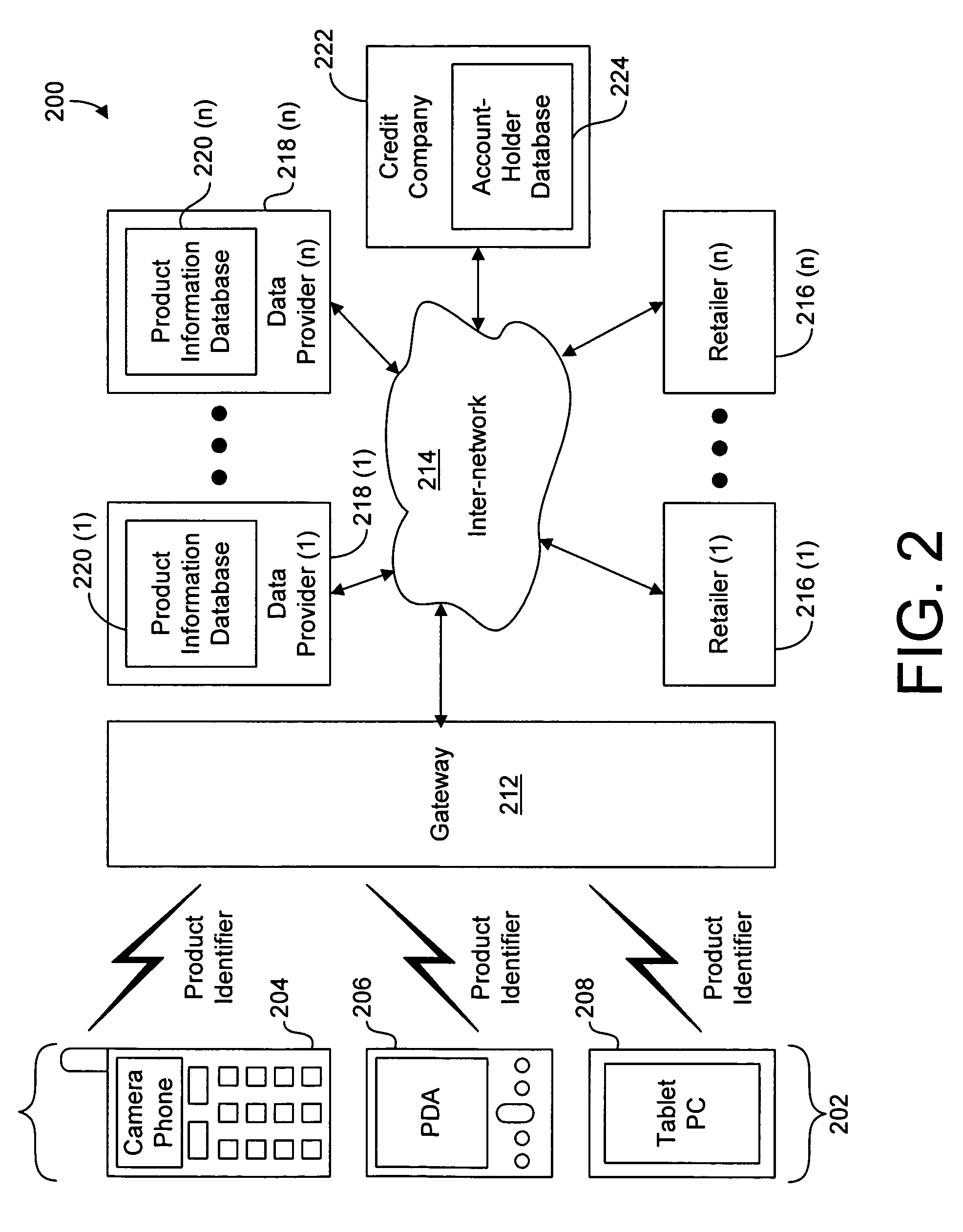

System and method for using product identifiers

InactiveUS20060200480A1Facilitates rapid information retrievalFast informationBuying/selling/leasing transactionsSpecial data processing applicationsInformation typeCamera phone

A novel method for using product identifiers includes capturing a product identifier identifying a product, selecting one of a plurality of queries, transmitting the product identifier and the selected query to a data provider, and receiving a response to the selected query from the data provider. The method is performed on a personal data device (e.g., a camera phone, PDA, tablet PC et.), which includes a network interface, a scanner operative to capture the product identifier, a user interface operative to receive the query selection, and an application program interface operative to associate the product identifier and the selected query, transmit the product identifier and the selected query to the data provider via the network interface, and to receive the response to the identifier and query from the data provider via the network interface. A method for the data providers to use the product identifiers is also disclosed, and includes receiving a request from a consumer including a unique product identifier and data indicative of the type of information requested, retrieving the type of requested information associated with the particular product from a database, and transmitting the retrieved information to the consumer. The data provider includes a database associating the product identifiers with information corresponding thereto, and means for the providing the associated information to the requesting consumer.

Owner:DAVID N HARRIS +1

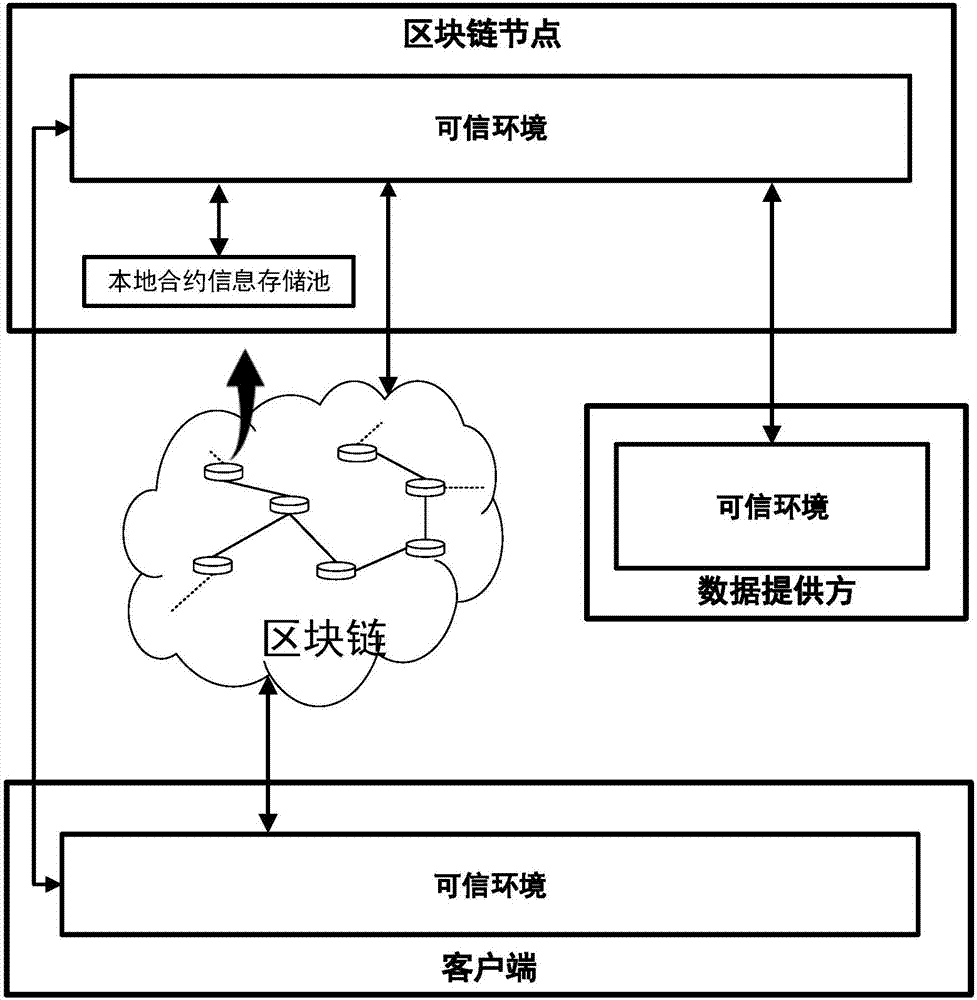

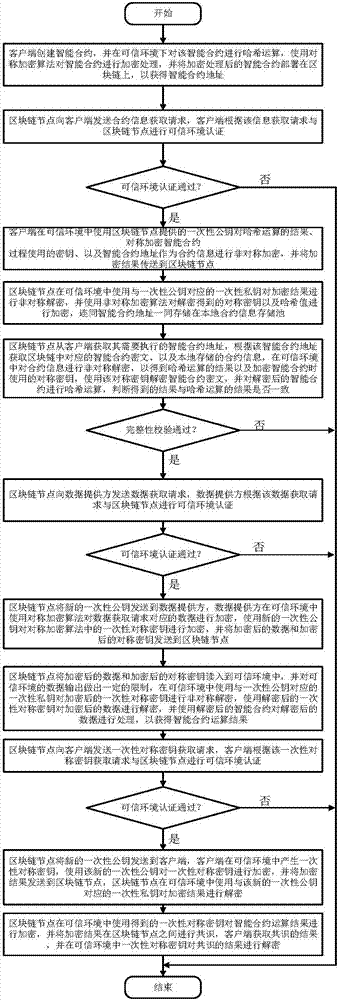

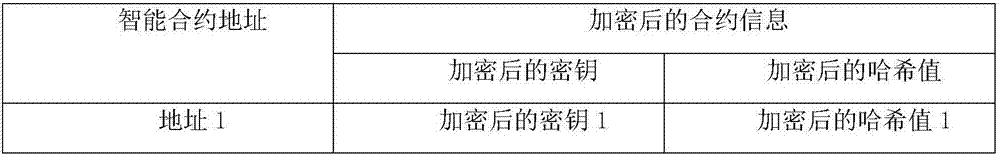

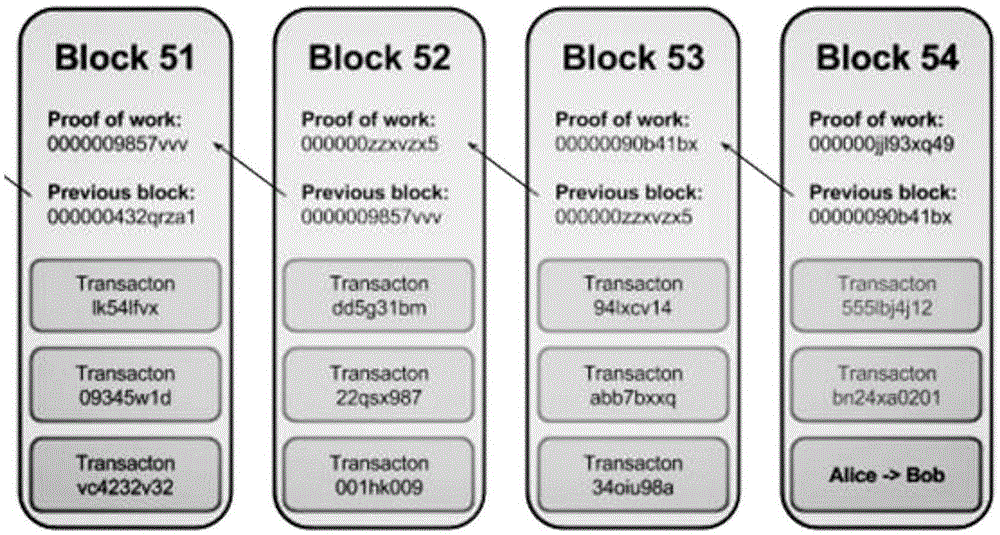

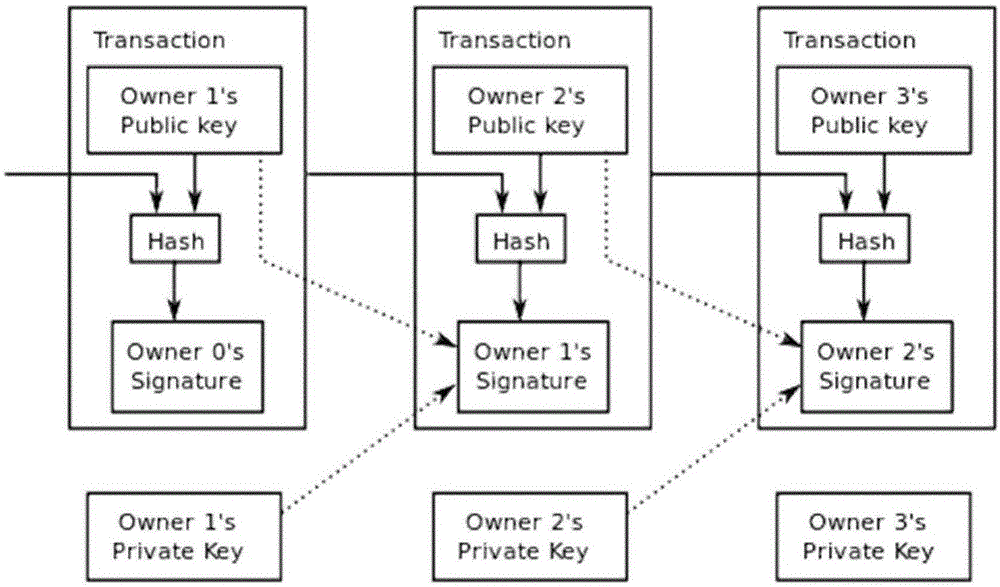

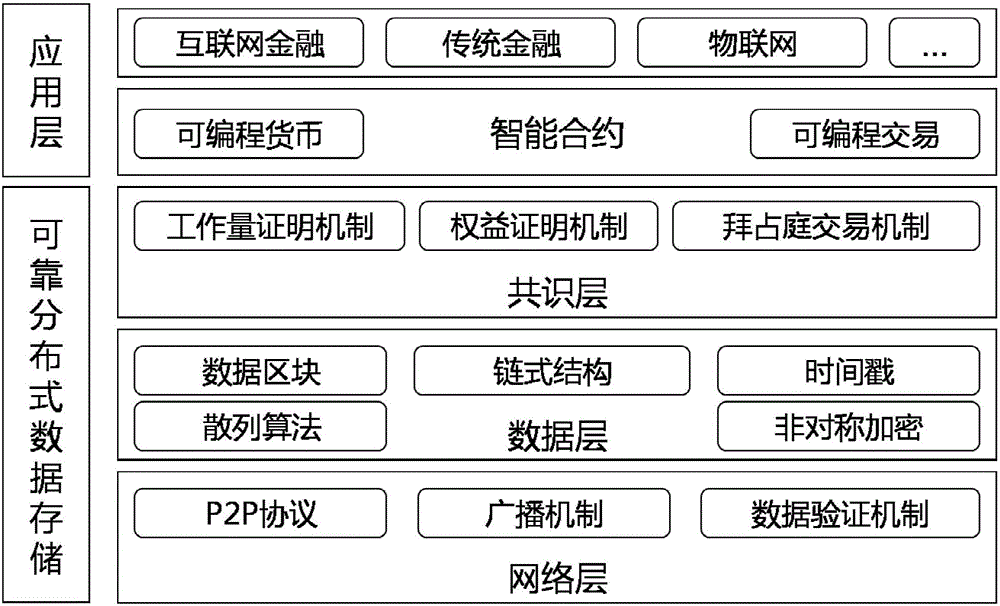

Smart contract protection method and system based on trusted environment

InactiveCN107342858ASolve the problem of smart contract versionSolve the problem of damage to rights and interestsKey distribution for secure communicationUser identity/authority verificationInformation processingInformation transmission

The invention discloses a smart contract protection system based on a trusted environment, including a client, block chain nodes, a data provider, a trusted environment, a non-trusted environment, a smart contract information processing module (A), a block chain node information transmission module (B) (such as a node interaction interface in the Ethereum), an input data transmission module (C), a smart contract execution module (D), a local contract information storage pool (E) and a block chain smart contract storage pool (F). The client is in communication connection with the block chain nodes. The data provider is in communication connection with the block chain nodes. The block chain nodes are in communication connection with one another. The technical problem that the copyright of smart contracts cannot be protected and the rights and interests of smart contract users are damaged due to the fact that the information of smart contracts may easily leak in the existing smart contract system and the technical problem that data may be stolen due to data leakage are solved.

Owner:武汉凤链科技有限公司

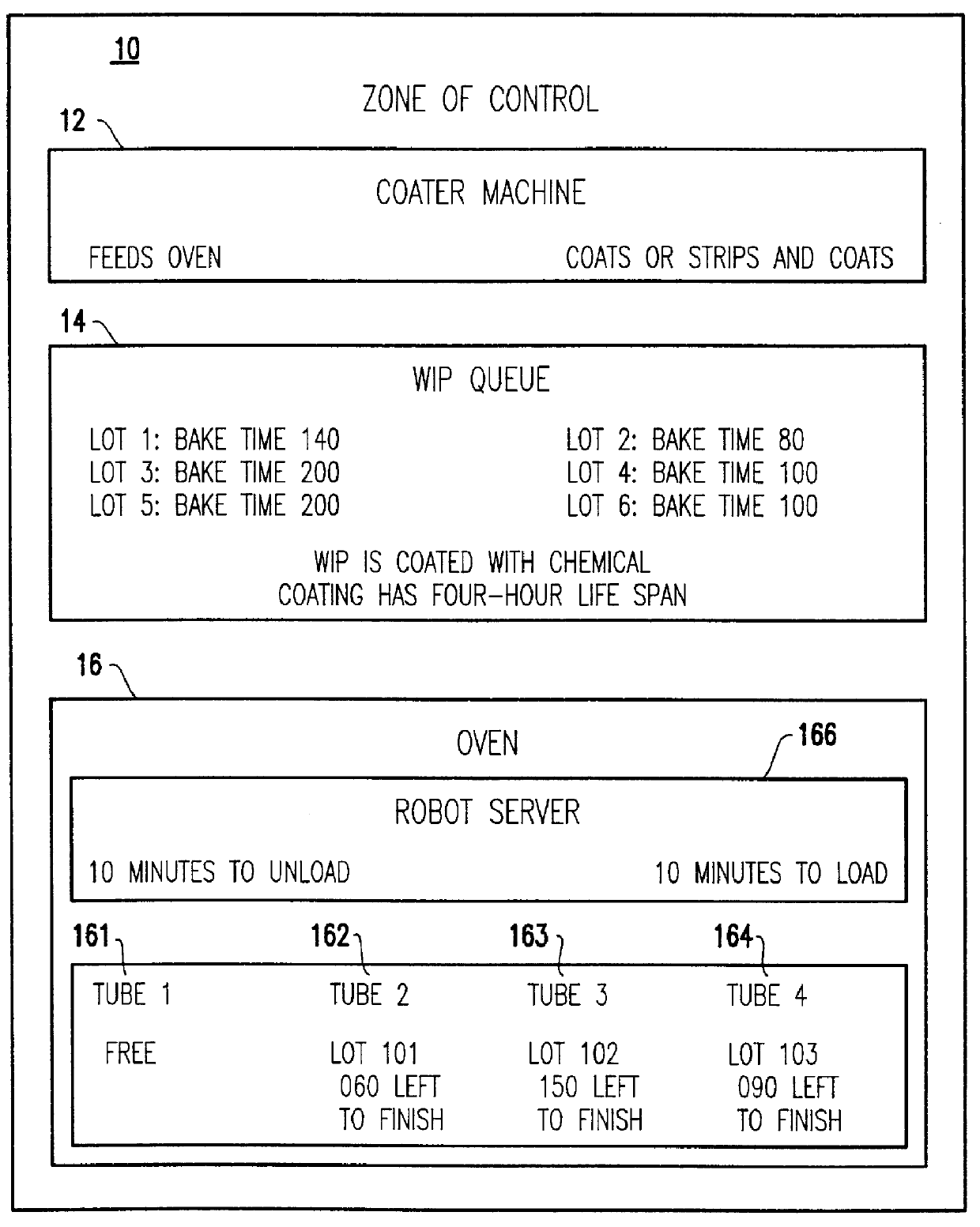

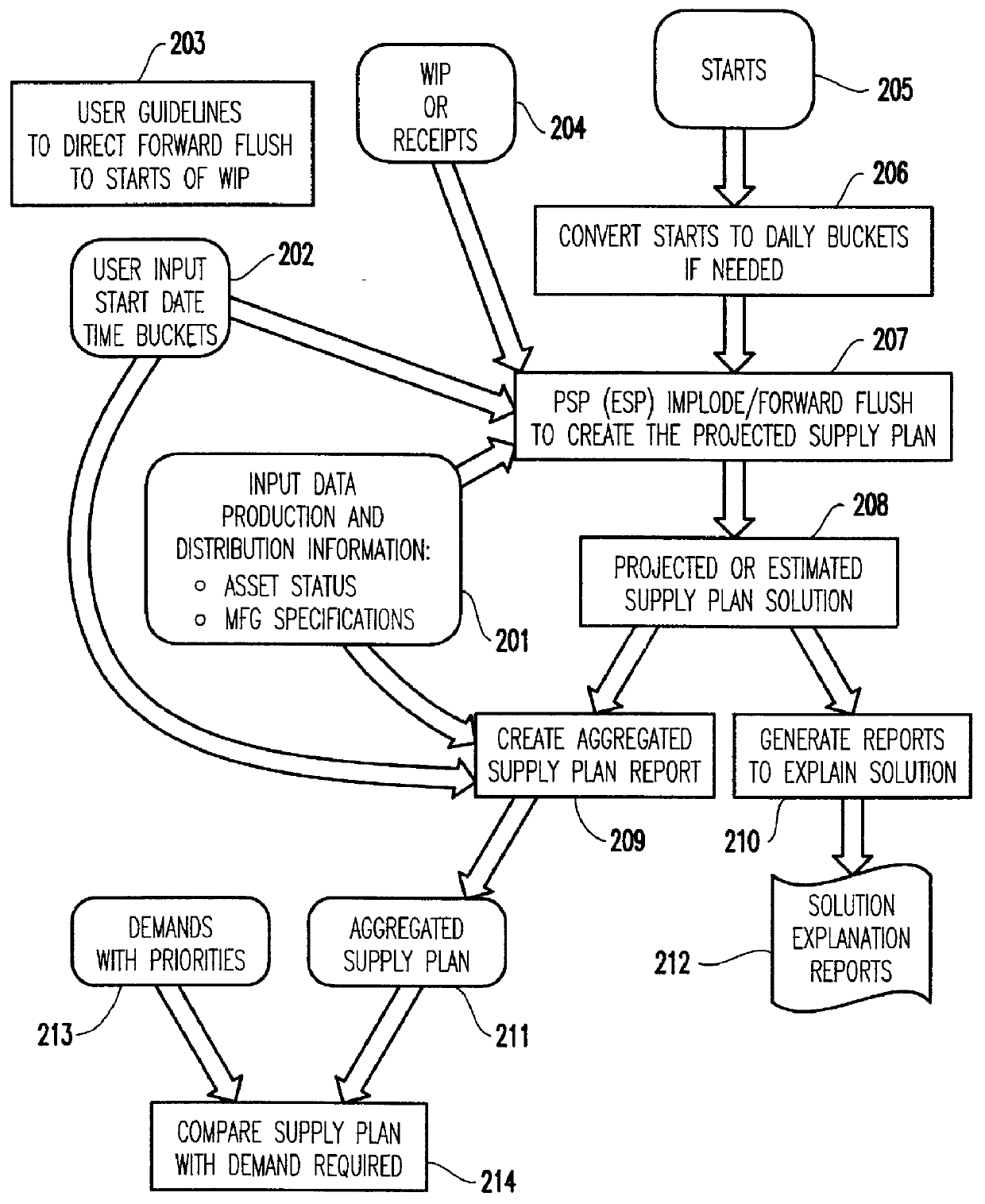

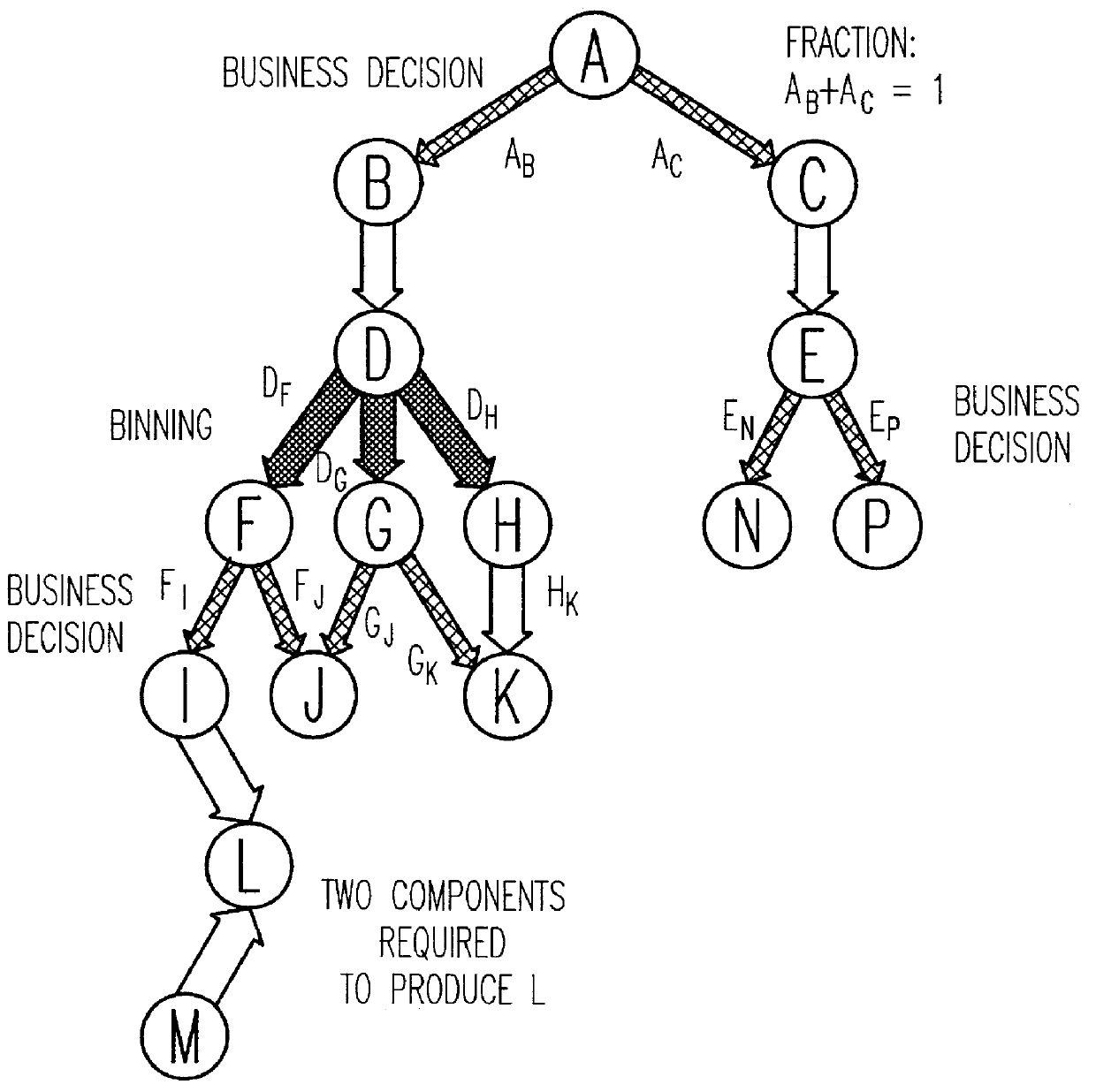

Projected supply planning matching assets with demand in microelectronics manufacturing

A computer-implemented decision-support tool serves as a solver to generate a projected supply planning (PSP) or estimated supply planning (ESP) match between existing assets and demands across multiple manufacturing facilities within the boundaries established by the manufacturing specifications and process flows and business policies to determine what supply can be provided over what time-frame by manufacturing and establishes a set of actions or guidelines for manufacturing to incorporate into their manufacturing execution system to ensure that the delivery commitments are met in a timely fashion. The PSP or ESP tool resides within a data provider tool that pulls the required production and distribution information. PSP matching is driven directly by user-supplied guidelines on how to flow or flush assets "forward" to some inventory or holding point. After the supply plan is created, the analyst compares this plan against an expected demand profile.

Owner:INDUCTIVE AUTOMATION LLC

Block chain-based credit investigation data sharing and trading system

InactiveCN106651346APerfect risk control levelSolve imperfectionsPayment protocolsBuying/selling/leasing transactionsRisk ControlData provider

The invention relates to a block chain-based credit investigation data sharing and trading system. The credit investigation data sharing and trading system comprises at least two P2P network nodes; each network node comprises an underlying block chain system and a credit investigation data sharing platform running in the underlying block chain system; and the credit investigation data sharing platform comprises a data sharing module, a data query trading module, a member management module and a block chain adaption layer. According to the credit investigation data sharing and trading system, a trusted credit investigation data sharing and trading platform is established by using a block chain technology; and special data sharing mechanism, data query mechanism and data trading mechanism are used, so that credit investigation data owners and credit investigation data demanders can be attracted to perform use, credit investigation data providers can perform data trading under the condition that data is protected, and credit investigation data queriers can obtain the credit investigation data to improve risk control levels of themselves.

Owner:上海凯岸信息科技有限公司

Systems and methods for monitoring data and bandwidth usage

ActiveUS8706863B2Assess restrictionData switching by path configurationResource utilizationData provider

Access to a communications network may be provided via a data provider that may charge for access. In some cases, the access fee may be related to the amount of network resources consumed (e.g., amount of data downloaded or bandwidth used). In some cases, a user may have access to a particular amount of data provider resources and be required to pay an additional fee for using resources in excess of the particular amount. To assist the user in managing his data resource consumption, a resource utilization component may provide different alerts and notices informing the user of current consumption, expected future consumption, and recommendations for reducing data provider resources consumed (e.g., stopping particular processes or data provider requests, such as downloading media). If several electronic devices in a network are connected to the same data provider resources, a network component may manage the data provider resource use among the several electronic devices (e.g., allow only particular users or devices access).

Owner:APPLE INC

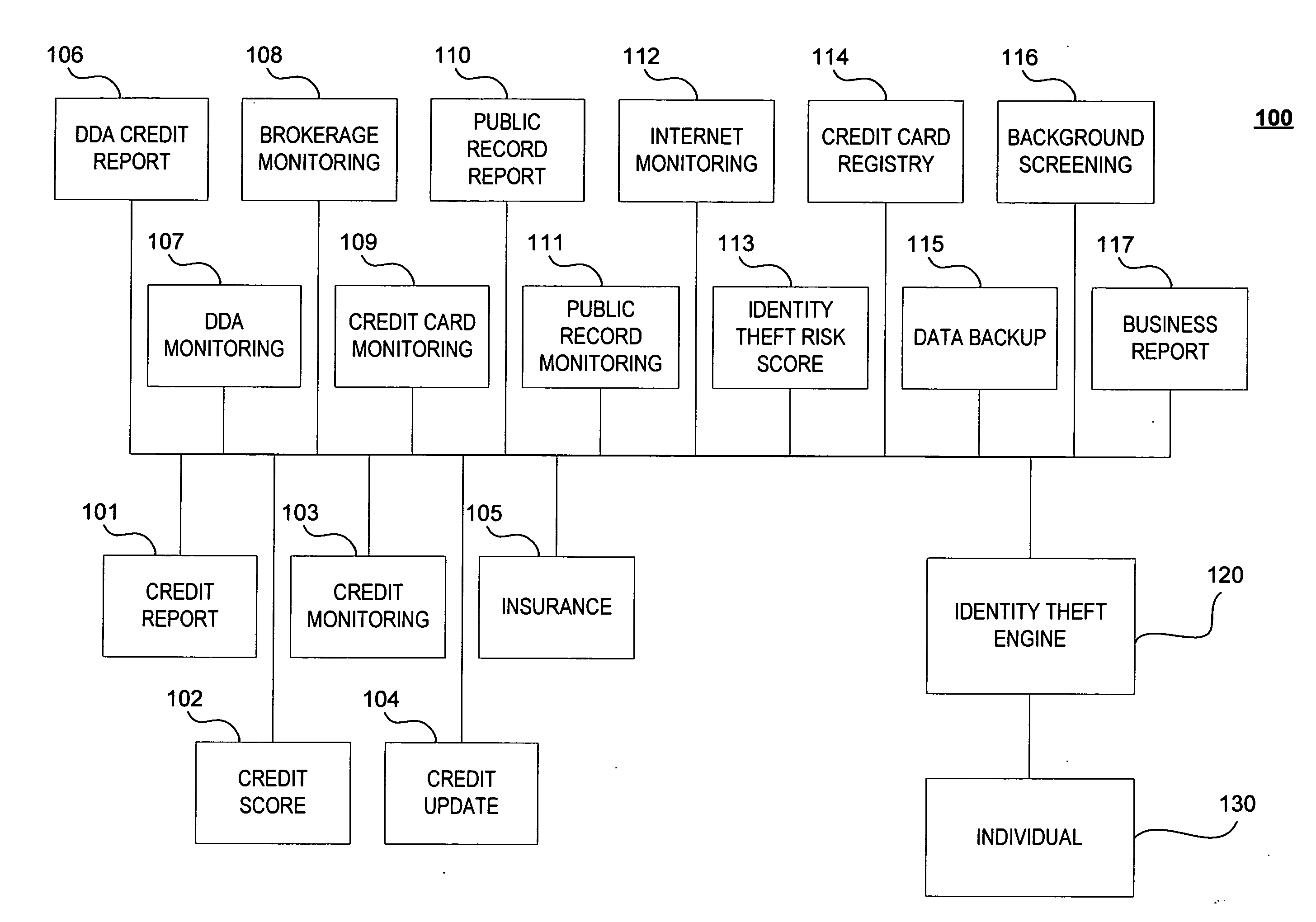

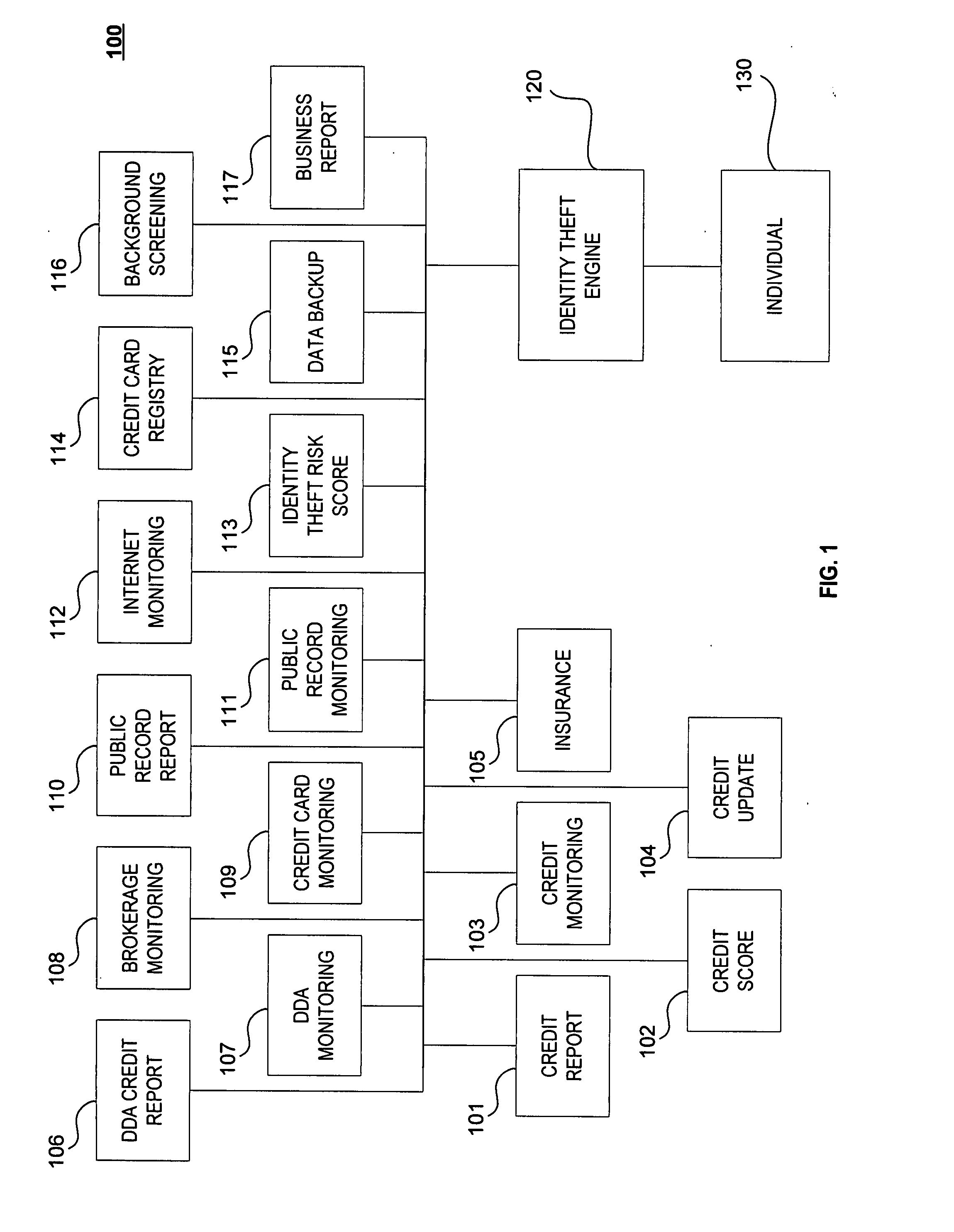

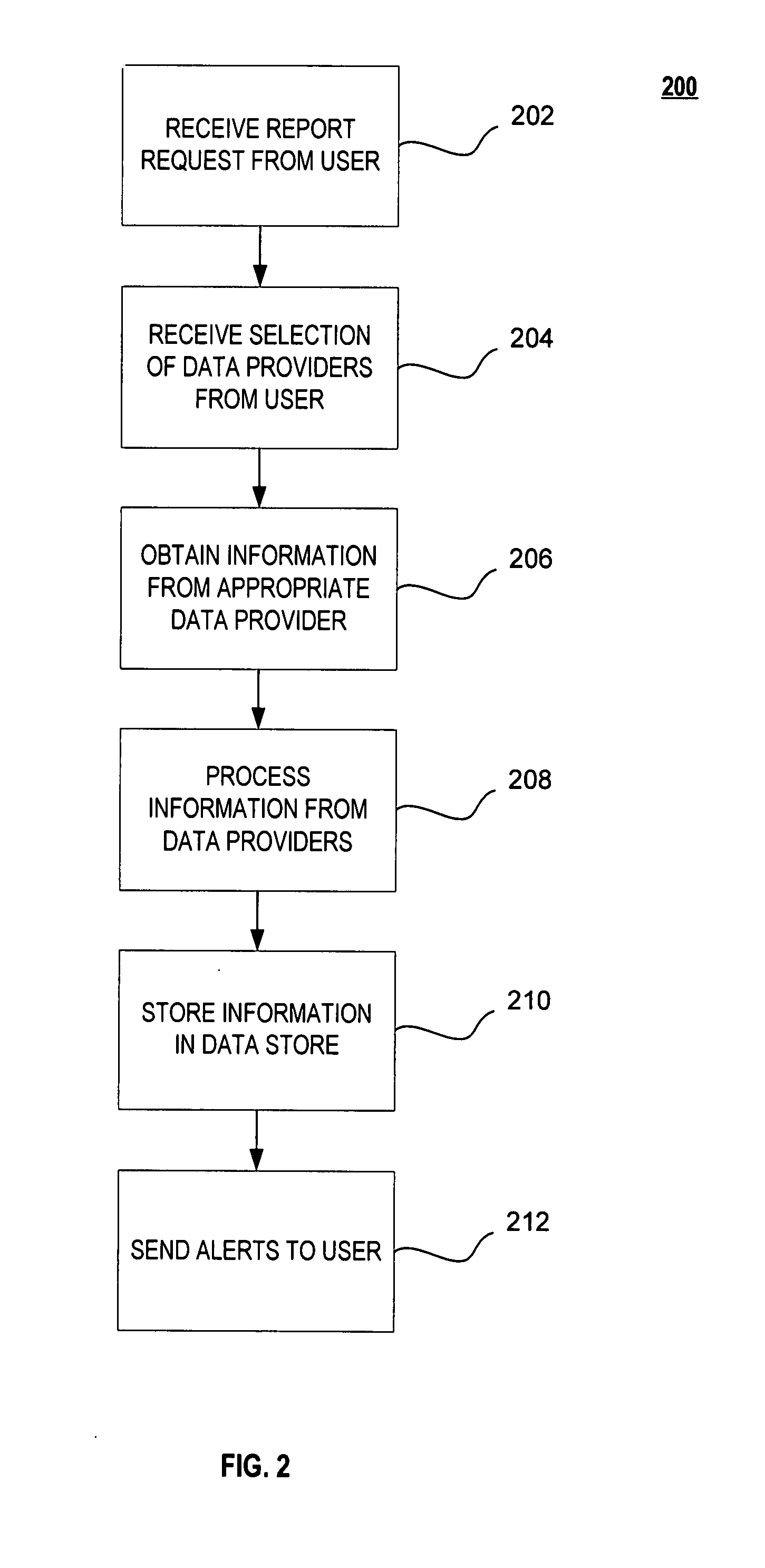

Method and system for preventing and detecting identity theft

ActiveUS20070244807A1Preventing and detecting identity theftStop in trackFinanceCredit cardData provider

A system, method and computer program product for receiving information relating to a financial account of an individual from at least one first data provider; receiving information relating to at least one of an identity theft expense reimbursement insurance policy of the individual, a public information relating to the individual, an identity theft risk score of the individual, a credit card registry of the individual, a backup data relating to the individual, a background information of the individual, and a business report relating to the individual, from at least one second data provider; and preparing a report relating to the individual's identity theft based on the information.

Owner:AURA SUB LLC +1

Methods and apparatus for a financial document clearinghouse and secure delivery network

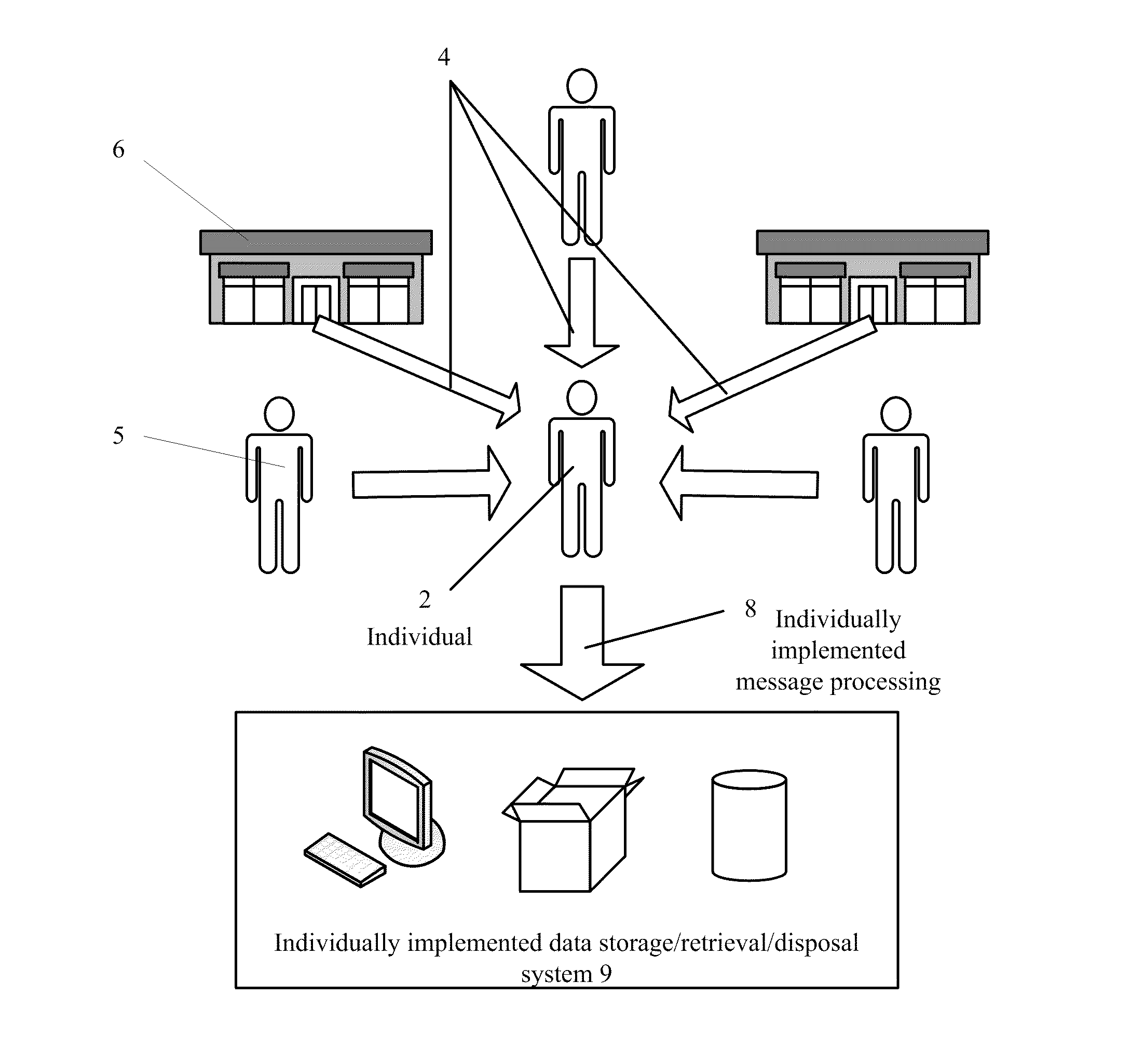

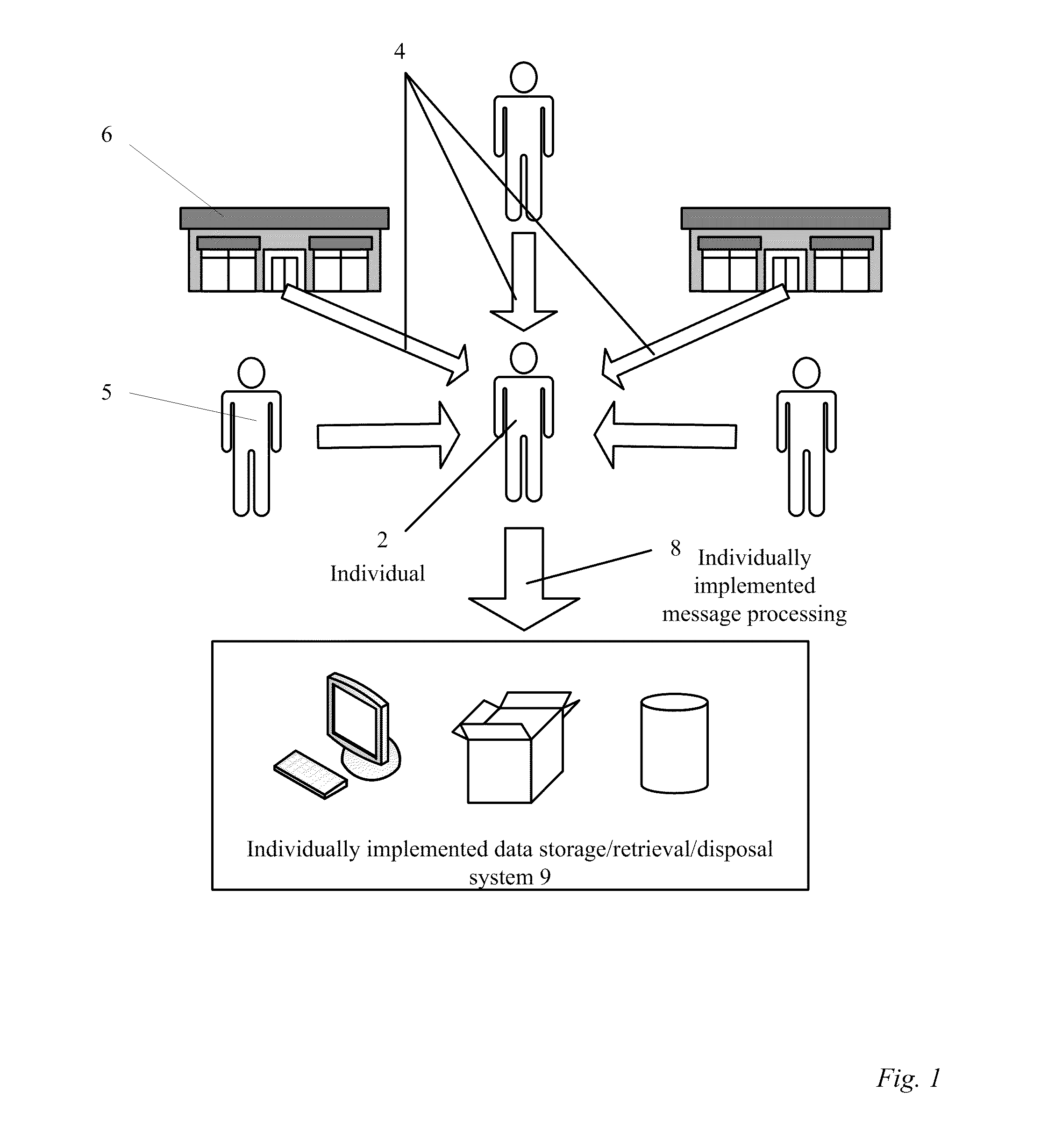

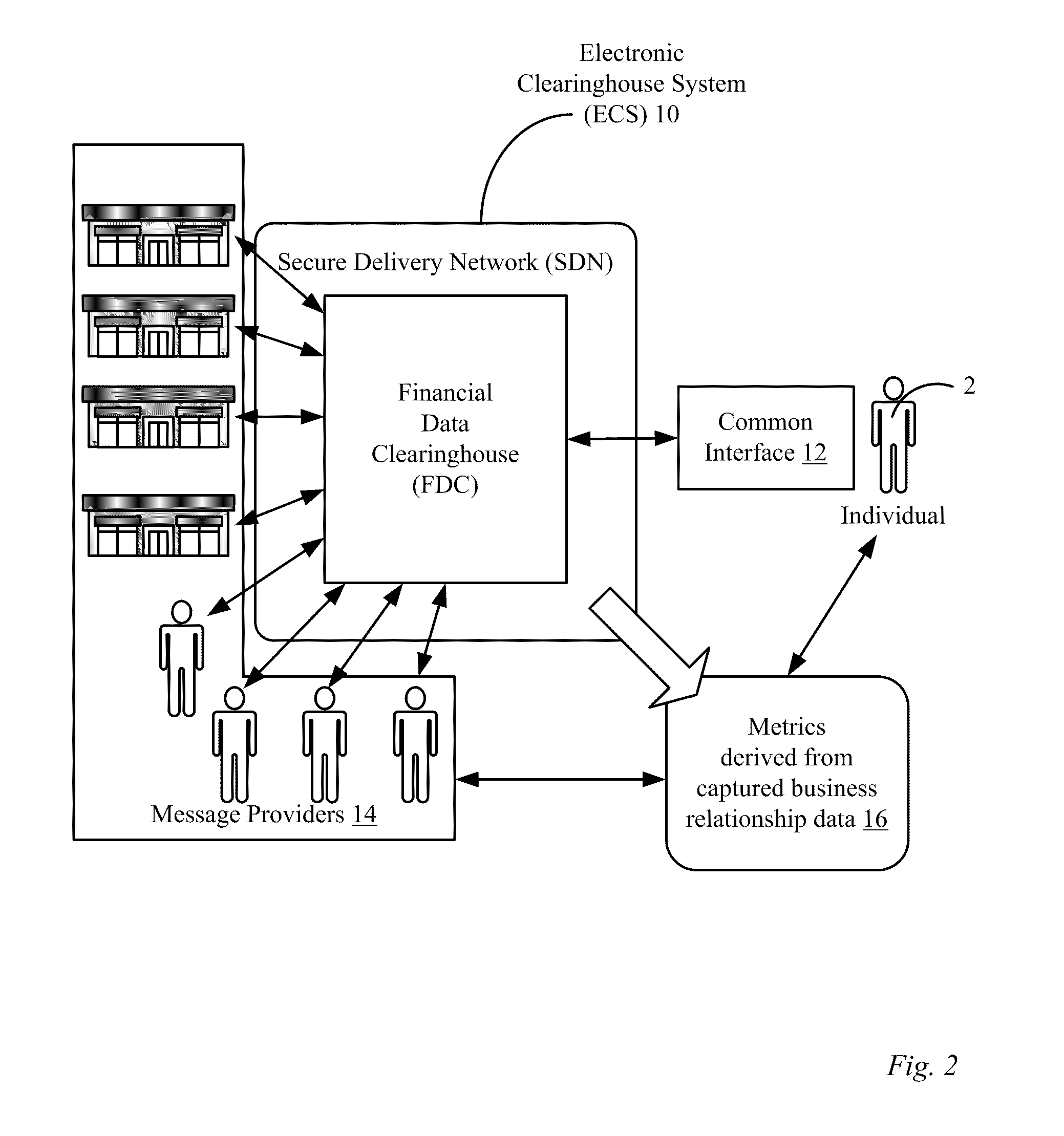

InactiveUS20110270748A1Simplify opting outMaintain privacyFinancePayment architecturePaymentDocumentation procedure

An electronic clearinghouse system (ECS) for securely delivering, retrieving, authenticating, storing, generating and distributing messages, such as financial documents and / or records are described. For message providers, the ECS can provide a secure and trusted venue for delivering messages, such as messages including financial data to their clients that reduces their delivery costs. For users of the ECS, the ECS can provide a central location where each user can receive and consolidate their messages, such as financial documents and associated financial data from a number of different financial data providers. To facilitate these functions, the ECS can include an automated system for recording delivery status as well as evidence of delivery of messages, including whether a message has been viewed by a particular user. Further, the ECS can include components for scheduling events, such as monetary transfers and bill payments, and providing reminders for such events. Also, the ECS can provide utilities that allow a user to package and securely deliver messages to other users.

Owner:T CENT

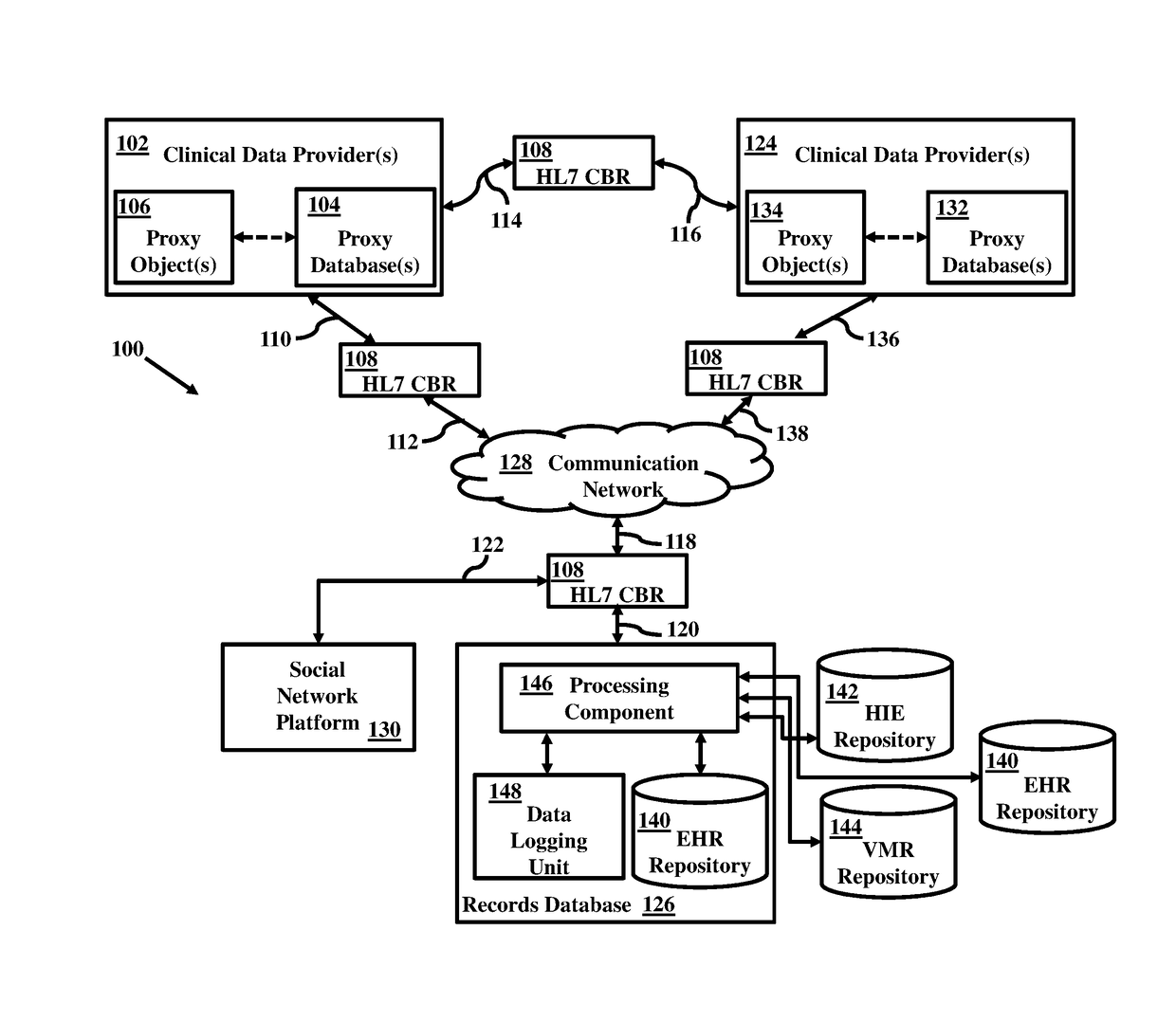

Blockchain system for natural language processing

ActiveUS20170103167A1Natural language translationData processing applicationsData providerData recording

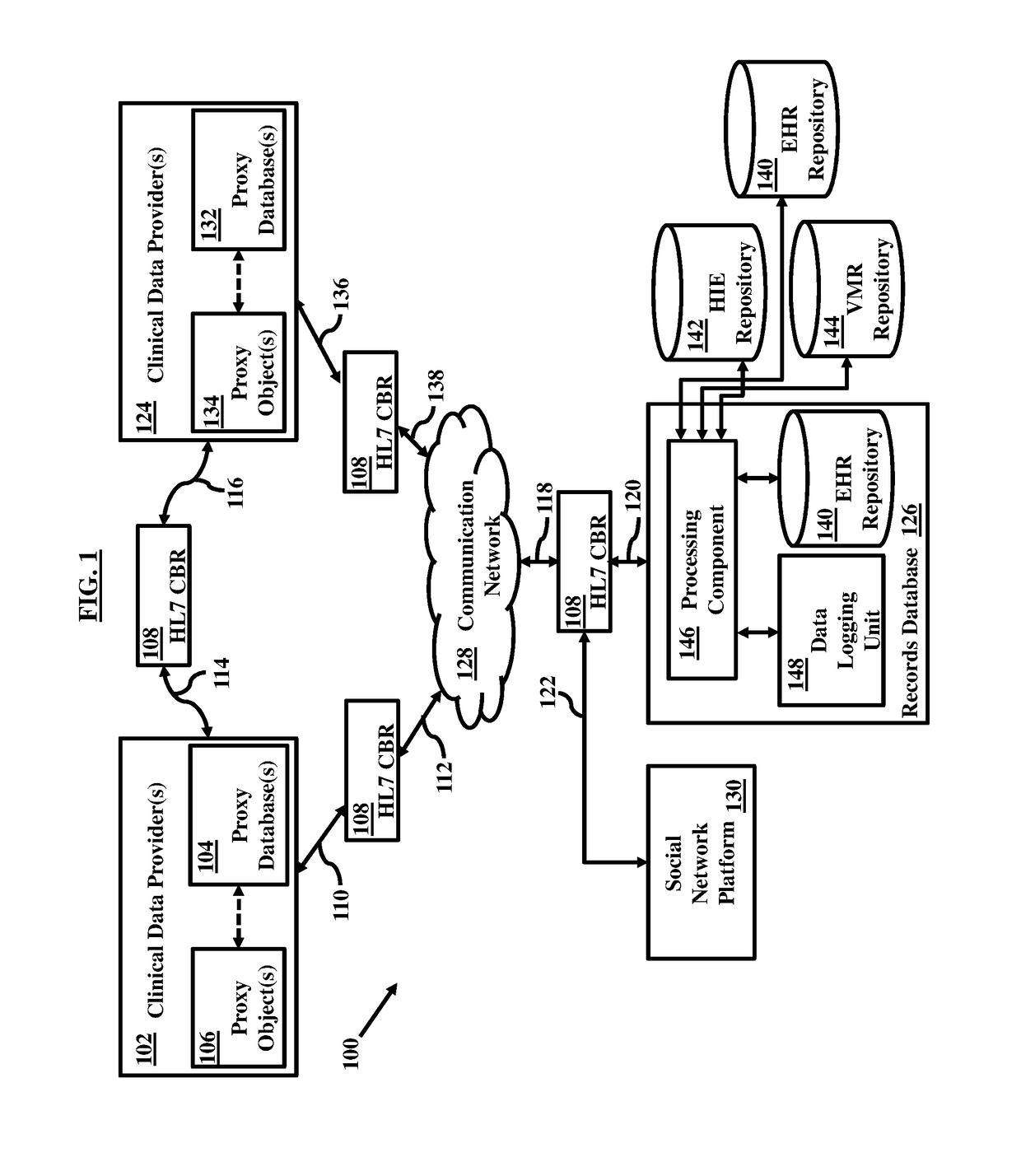

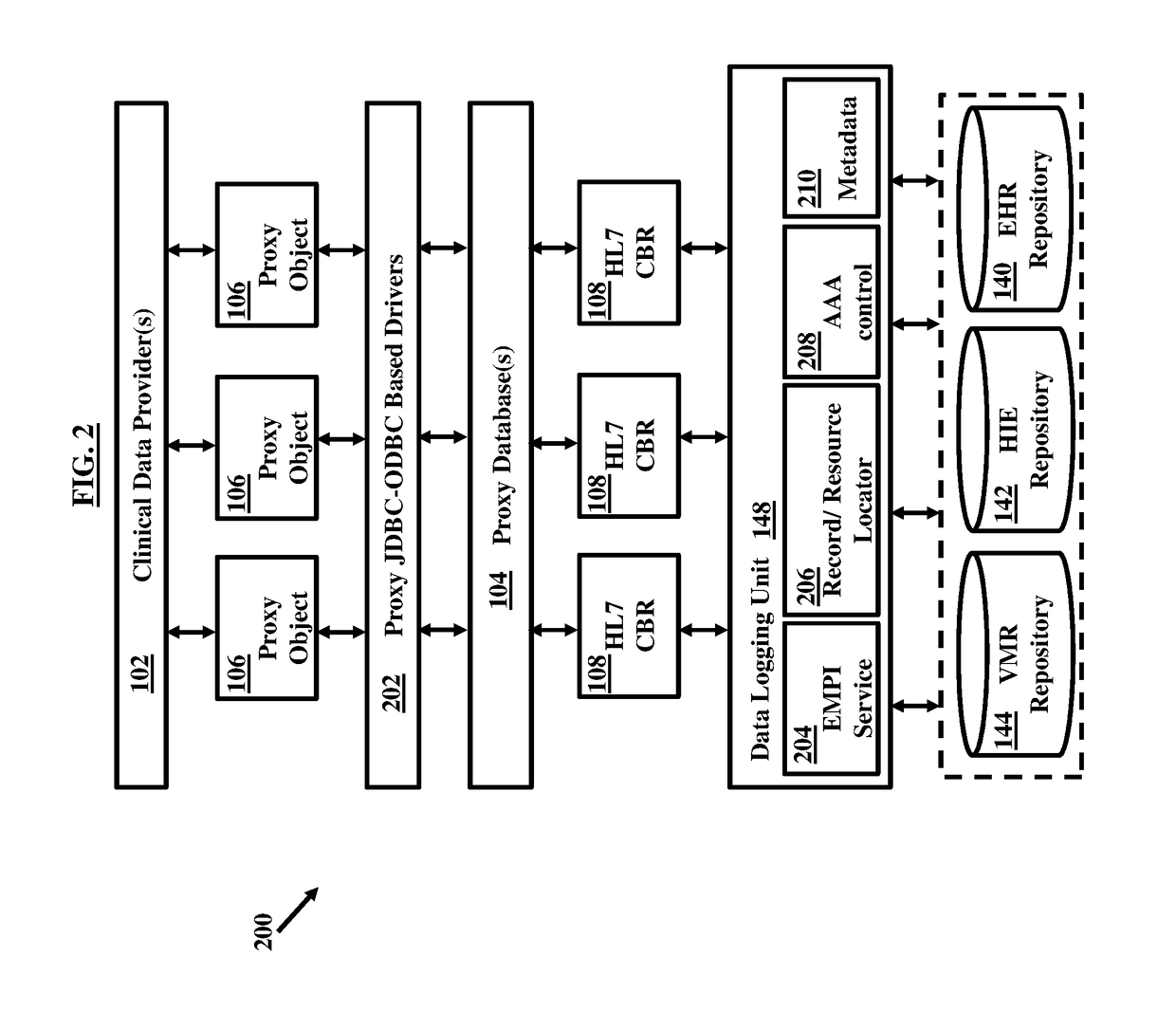

A blockchain configured system includes a router and a blockchain configured record bank. The router collects data and converts it in a format in accordance with a defined standard. The blockchain configured record bank can include or be coupled to a data repository. The blockchain configured record bank can be configured to be coupled to the data provider through the router over a communication network. The blockchain configured record bank stores the data received from the data provider and can be accessible or searchable from within or outside the blockchain configured record bank. The blockchain configured record bank can be coupled to or include a data logging unit that maintains metadata associated with the data and configured to facilitate natural language processing capabilities. The router and the blockchain configured record bank may be coupled to machine learning system, metadata validation system, and master data validation system.

Owner:NETSPECTIVE COMM

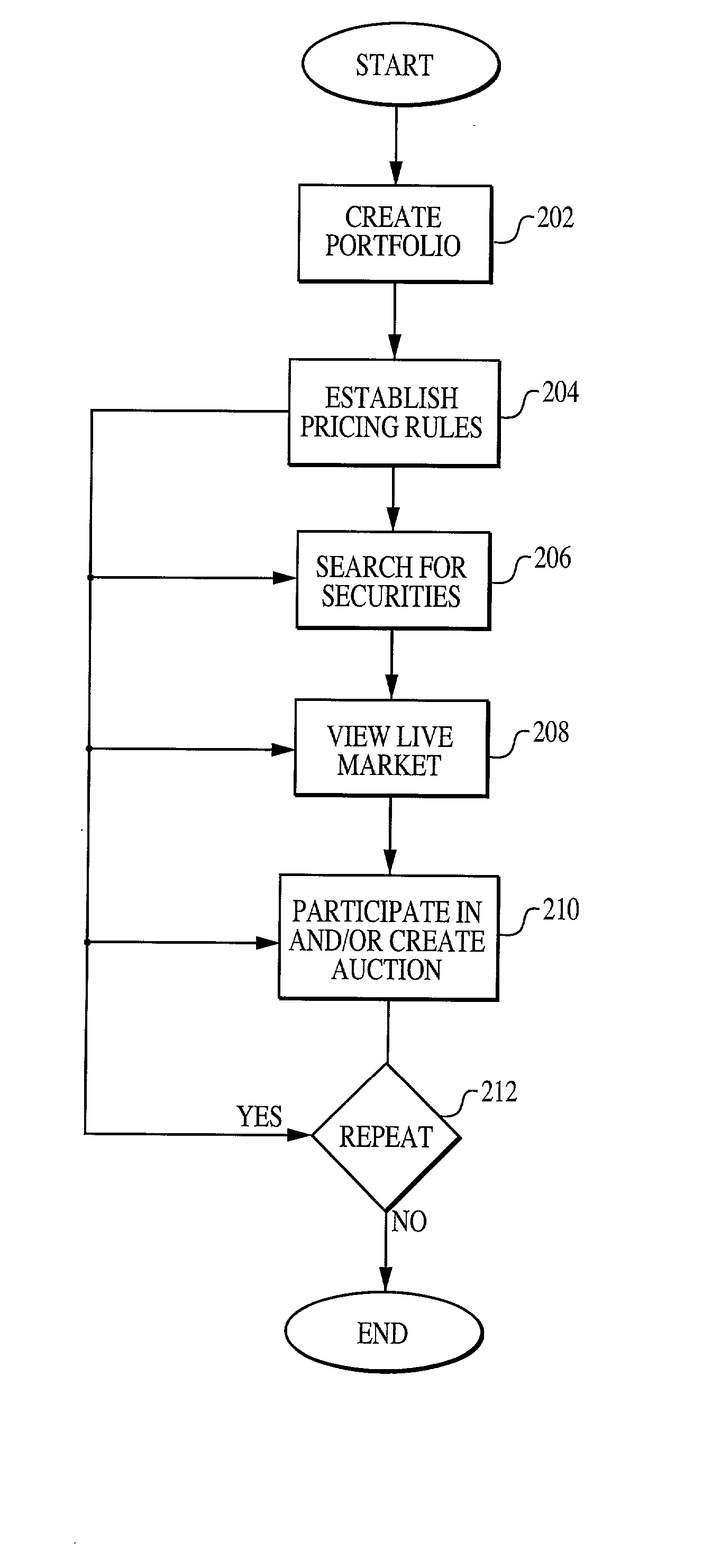

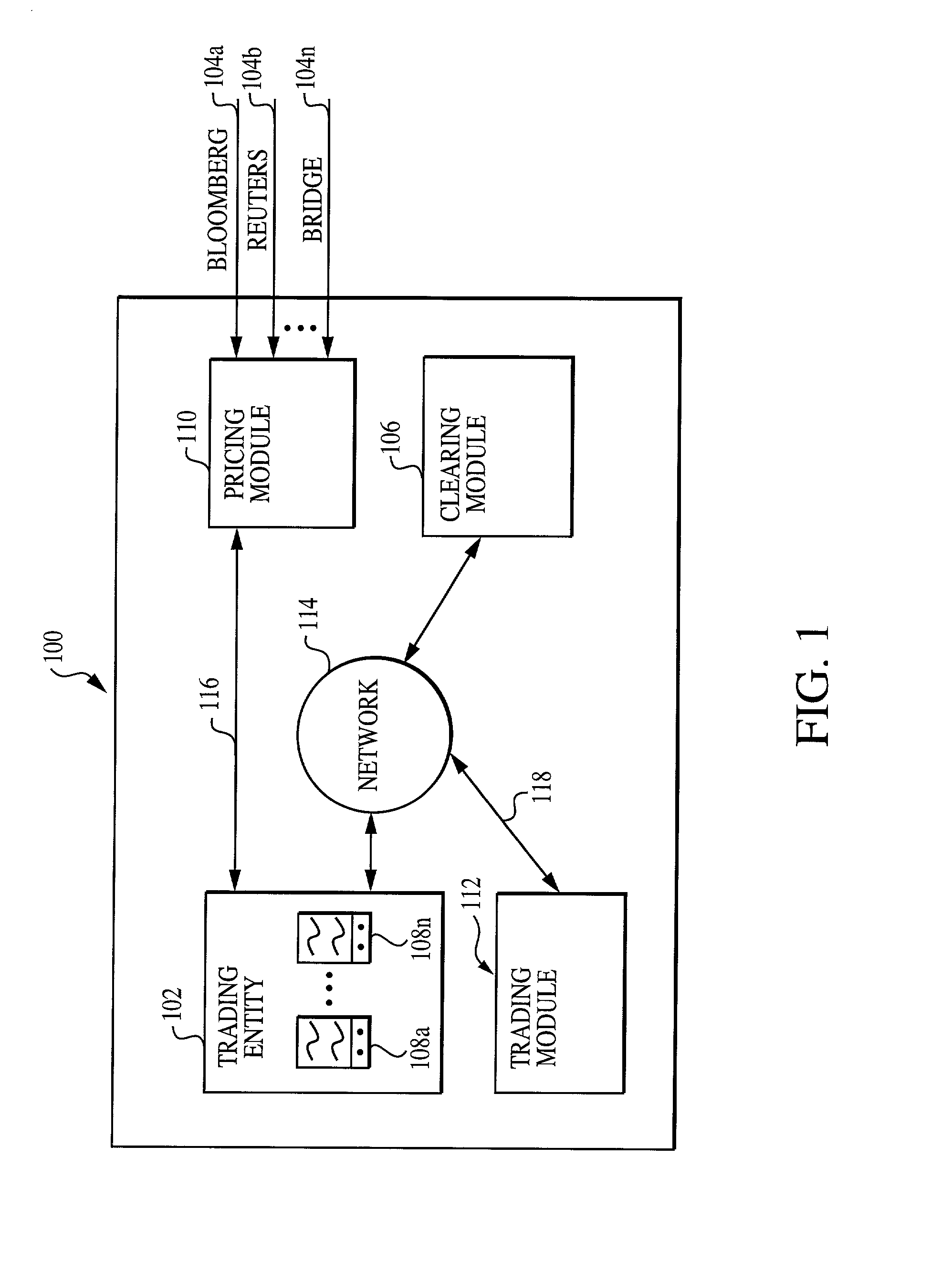

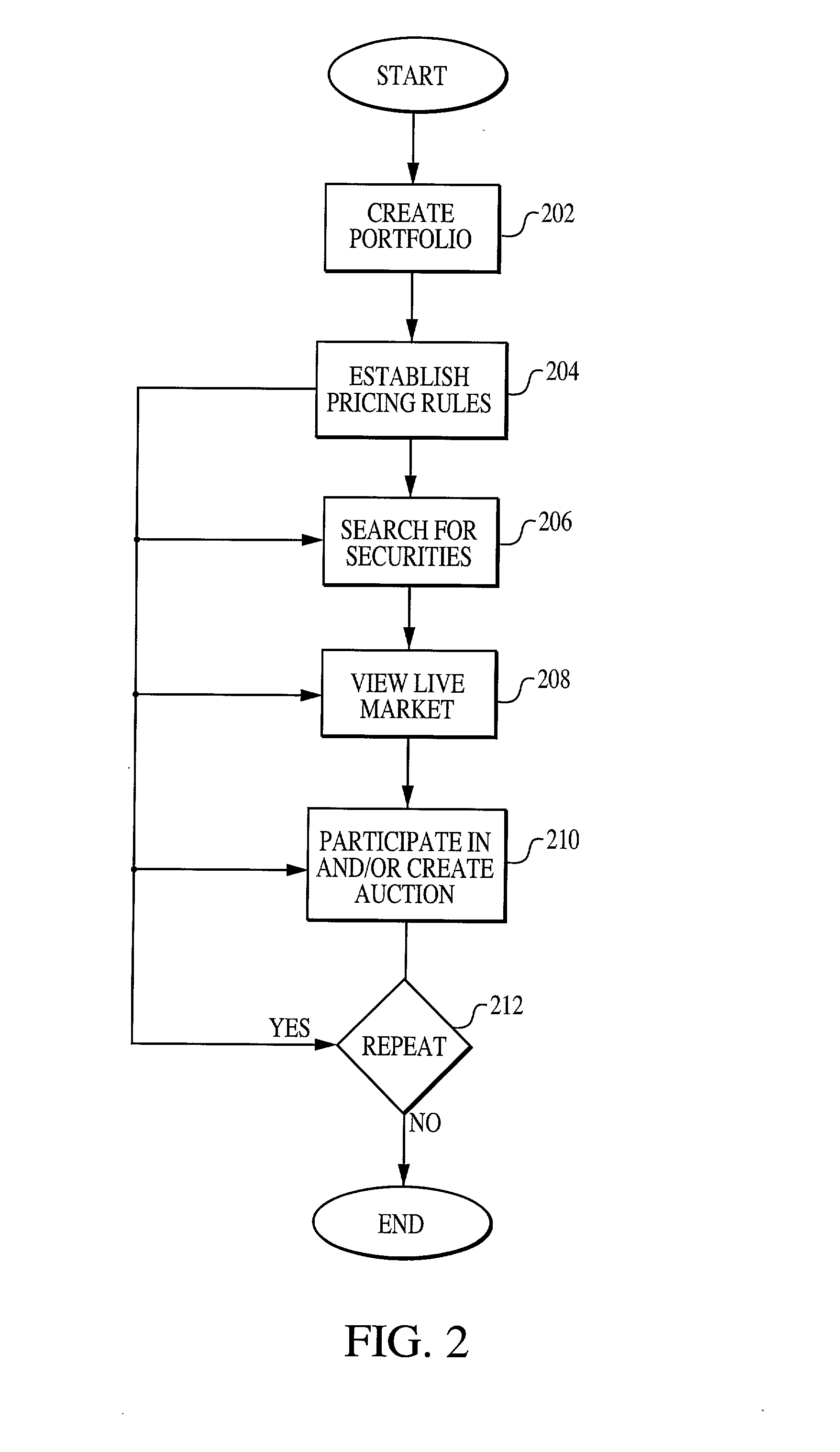

System, medium and method for trading fixed income securities

A system, method and medium for performing electronic fixed income trading that allows users to specify and / or control price and / or time limits associated with potential trades while preserving buyer and seller anonymity. According to at least some of the embodiments of the present invention, a pricing module receives financial information from at least one financial data provider, and transmits the data to one or more trading entities. Purchase and / or sell offers are transmitted to a trading module, and can be defined according to any of a plurality of pricing methods. Depending on the user specified parameters that comprise the offer, the system can automatically place the user into the market, or automatically take the user out of the market. Once a trade is executed, a clearing module monitors and records the transactions executed in clearing the trade.

Owner:TRUMARKETS

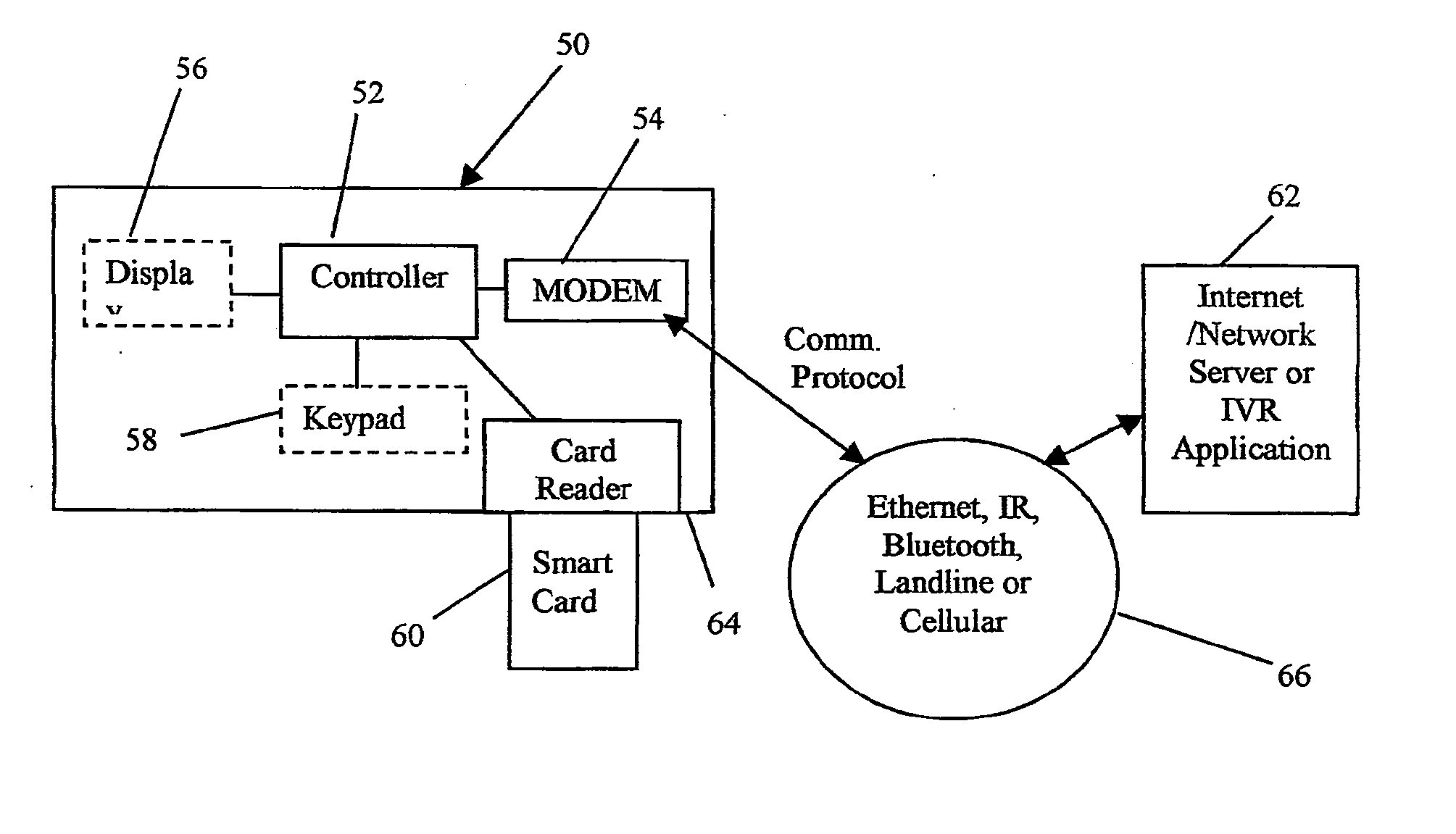

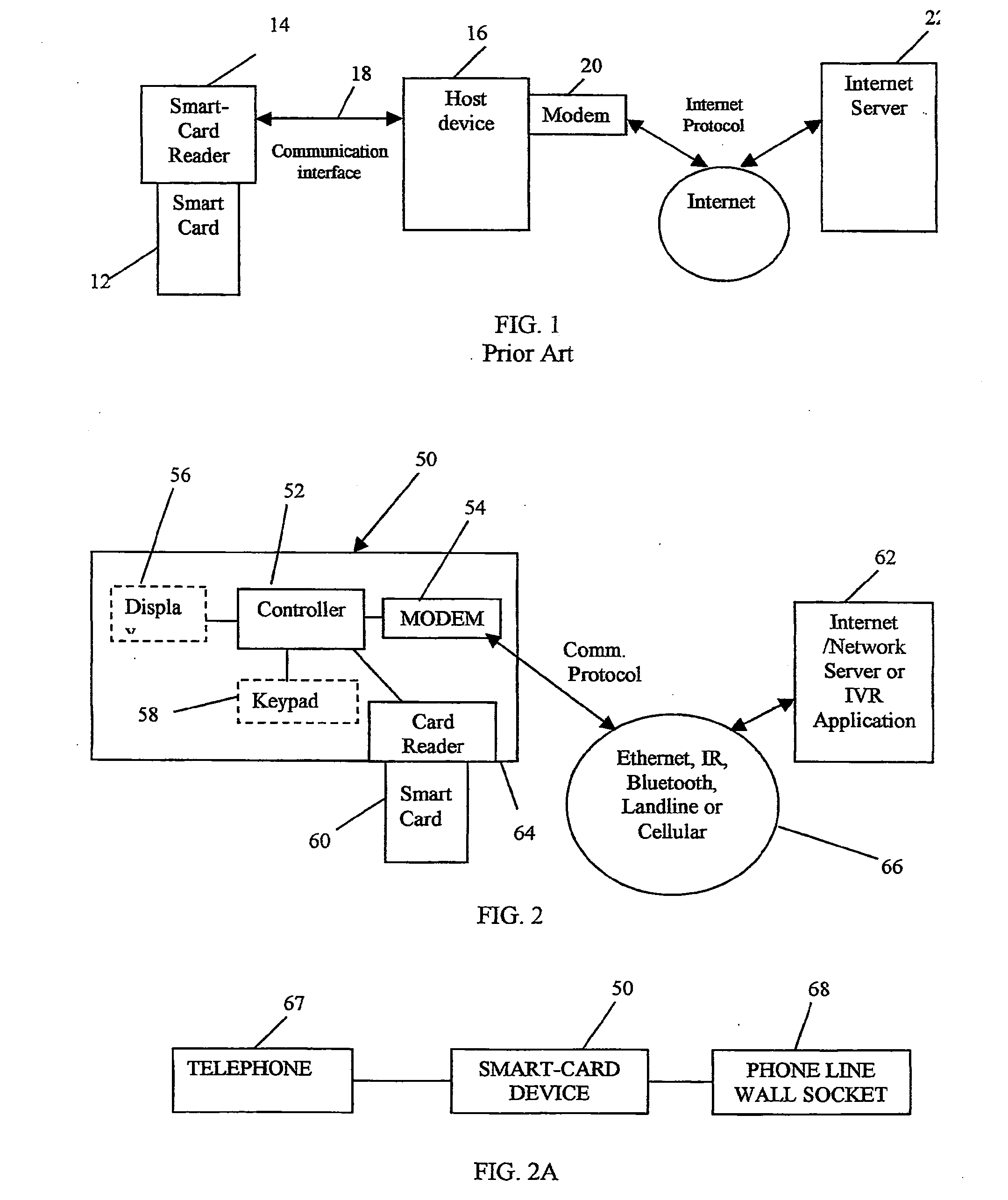

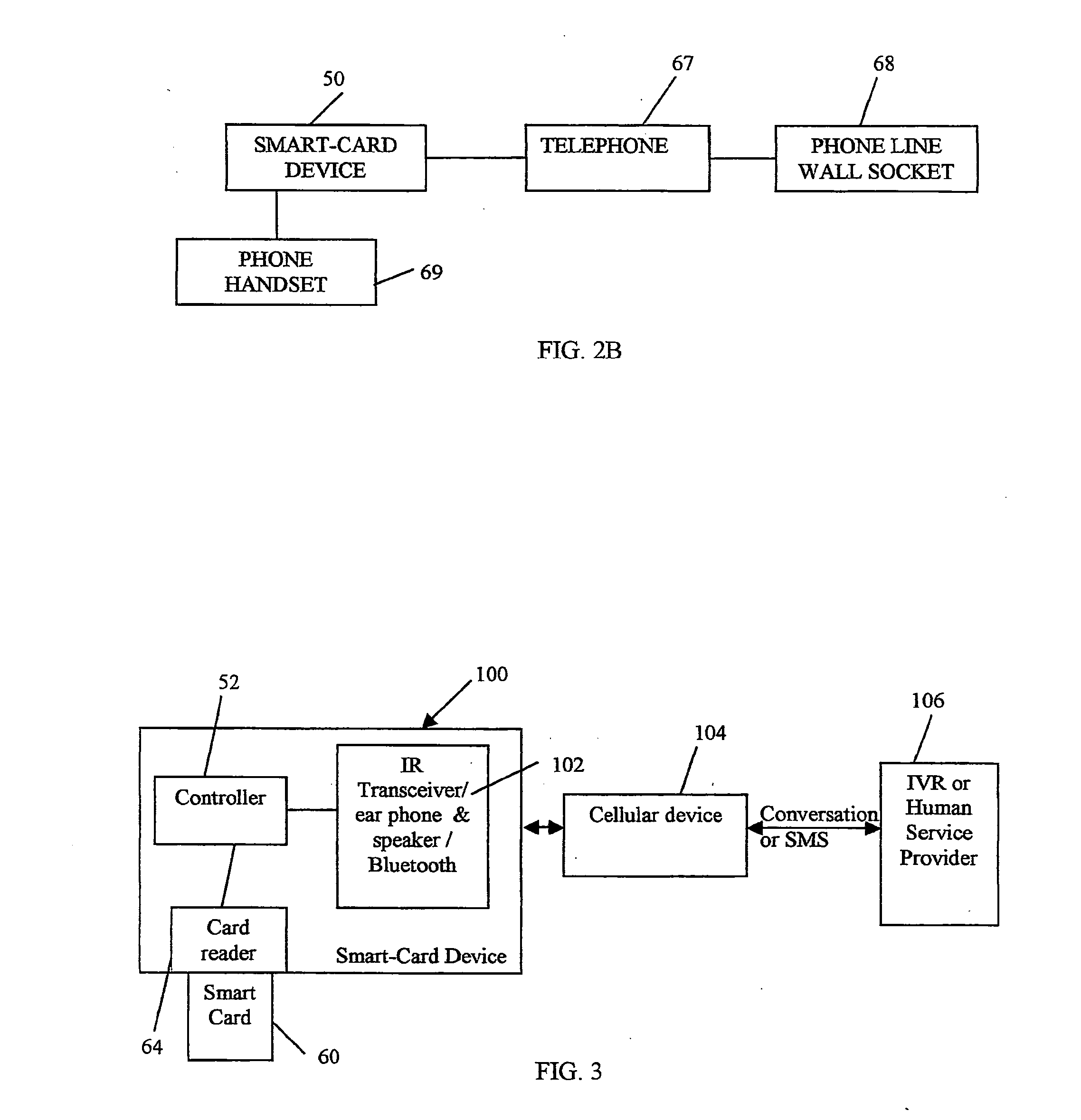

Smart card network interface device

InactiveUS20060006230A1Cordless telephonesDevices with card reading facilityData providerPersonalization

A securely identifiable network device is provided. The device may be directly hooked to a network or Internet via a phone or other communication interfaces. The device includes a smart card reader and a communications interface, such as a MODEM, RS-232, infra-red interface, RF, tone, or an Ethernet interface, and a minimal device controller. The combination of these components allows for generating a fully authenticated access to a networked data server (e.g. mail, SMS, phone switch), for personalizing the access point behavior, and for notifying the data provider about the current location of the cardholder. This allows for re-routing the required data messages to the current location. The service data messages are typically SMS, MMS, e-mail and phone calls.

Owner:BEAR ALON +1

Method and system for managing distributed trading data

InactiveUS7565313B2Avoid misuseMaximizing internalization rateFinanceCommerceData providerTransaction data

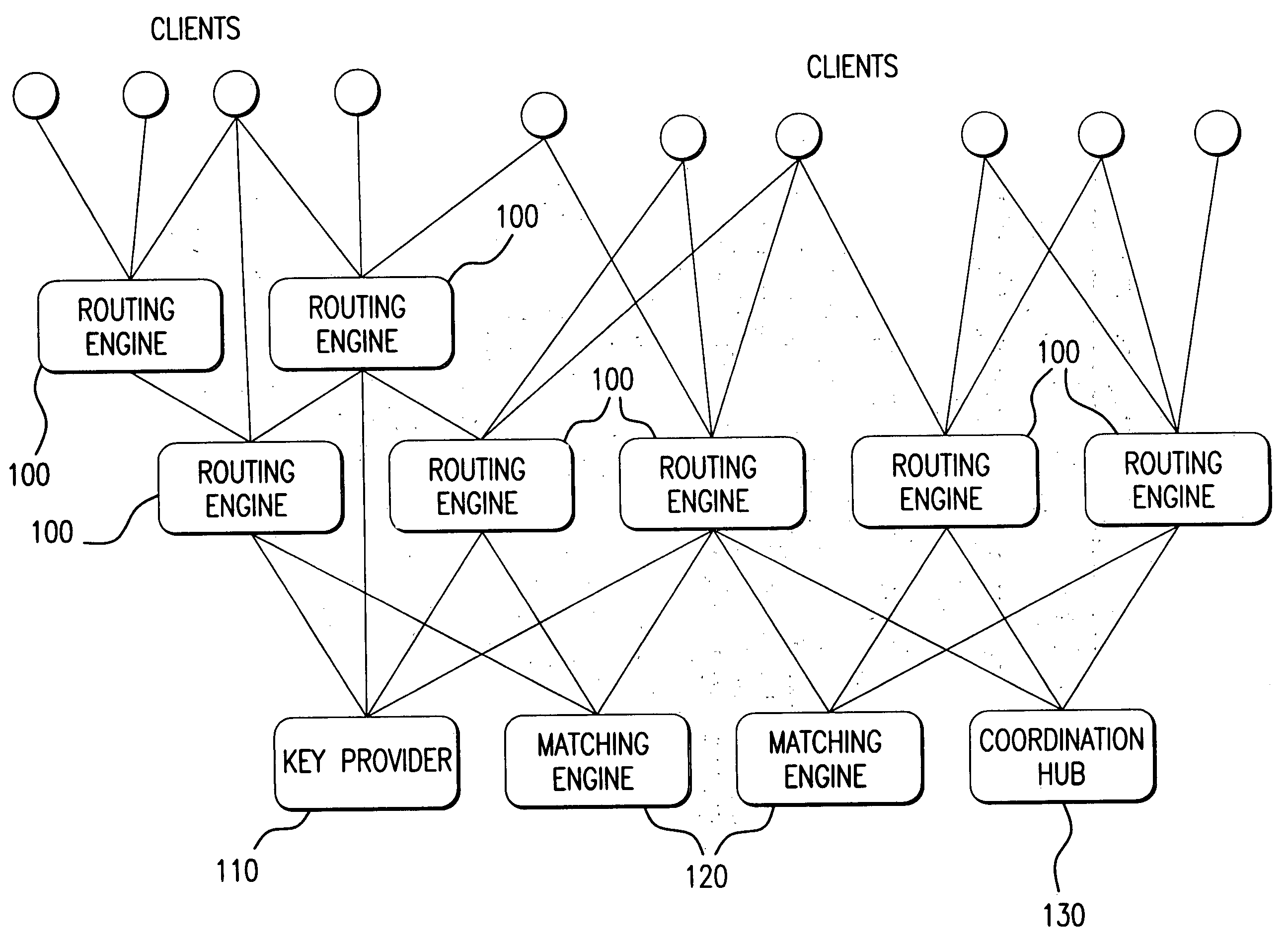

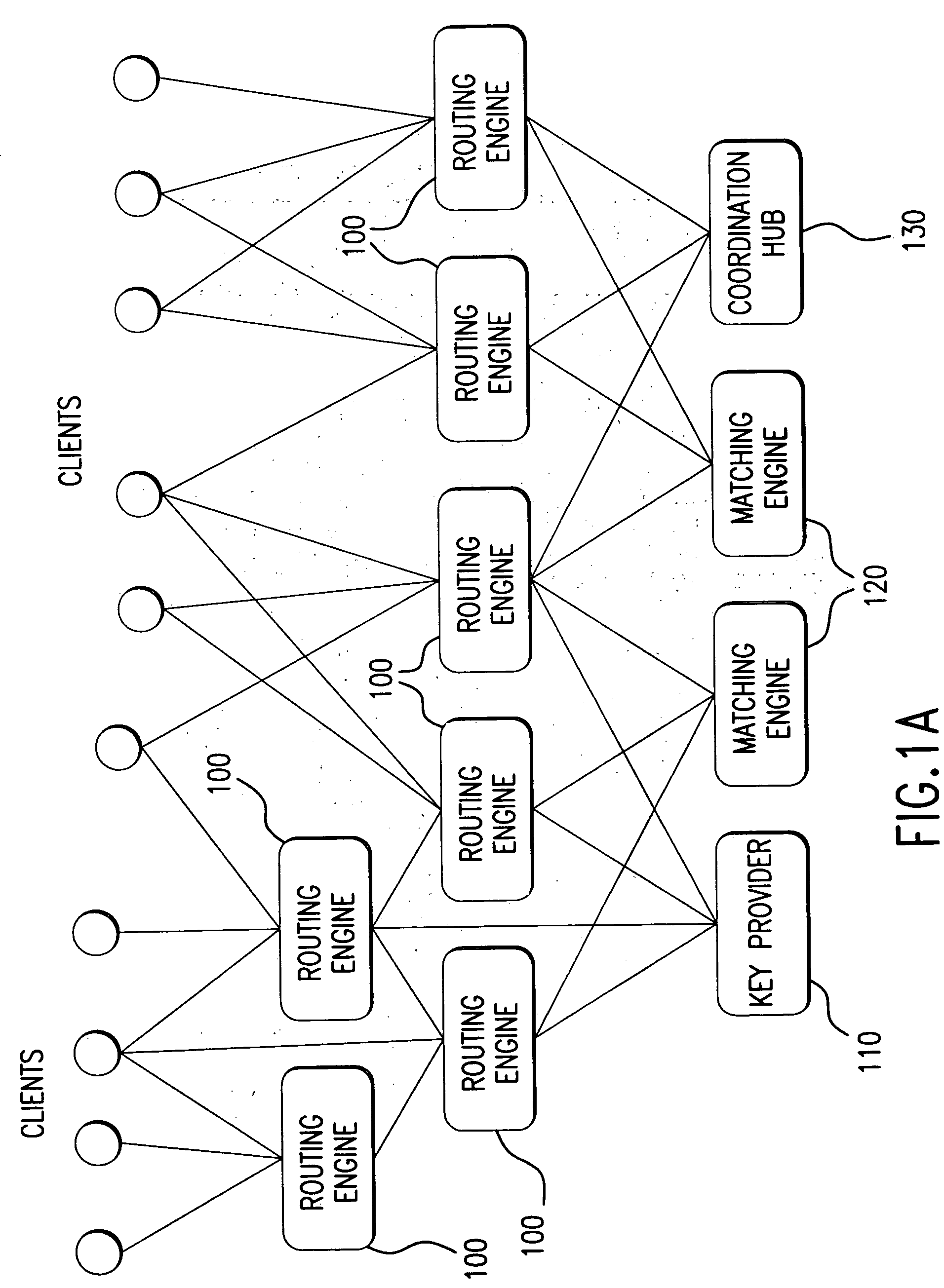

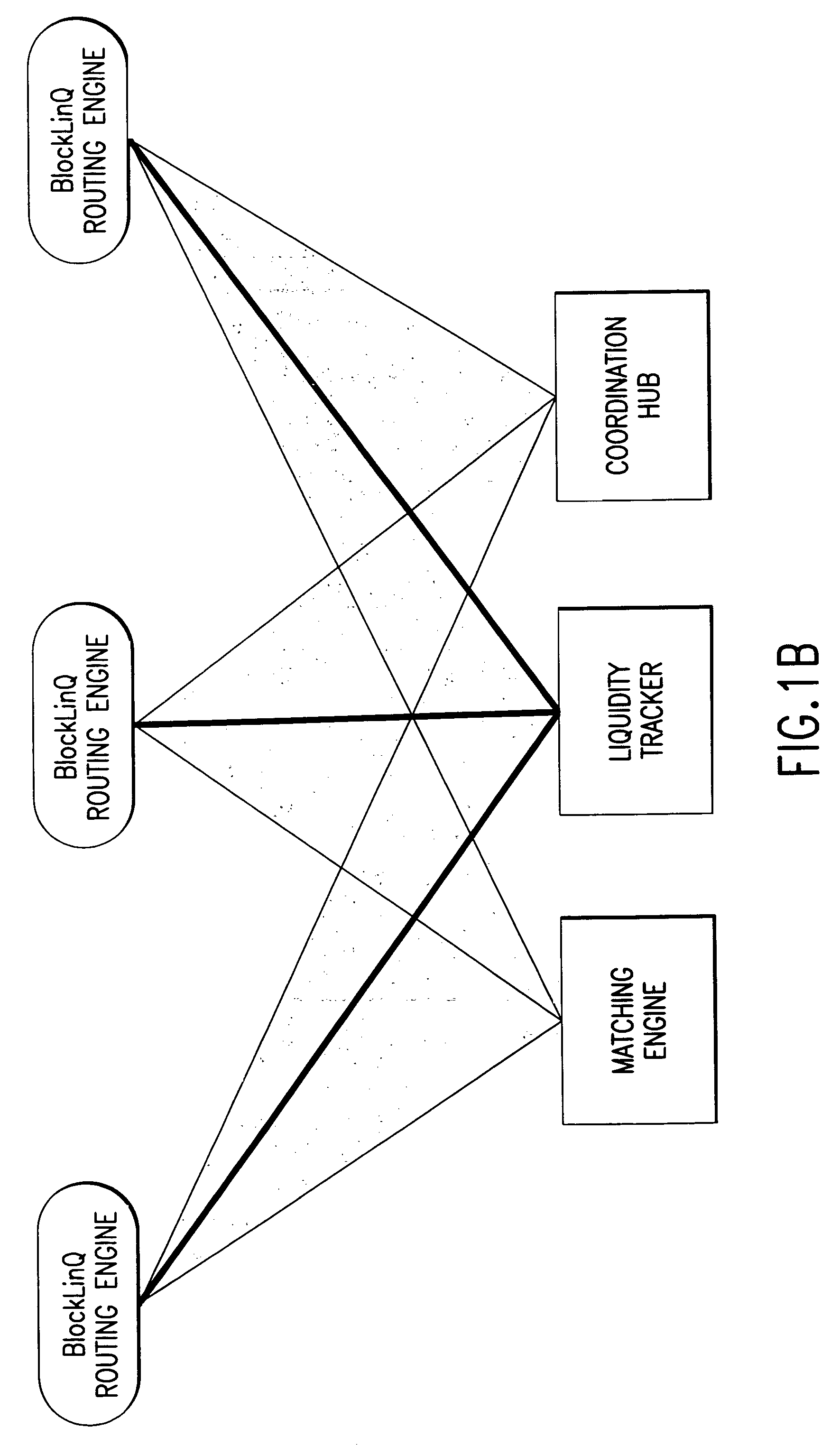

In a preferred embodiment, the invention comprises a computer-implemented system and method of managing market information across a network of data providers, comprising the steps of: (a) electronically receiving first data including confidential information regarding market participants in a first system that protects said first data behind a firewall; (b) electronically receiving second data including confidential information regarding market participants in a second system that protects said second data behind a firewall; (c) electronically receiving an order and targeting parameters from a first market participant; (d) electronically issuing an advertisement request message to said first system and said second system, said advertisement message comprising display attributes of said order and comprising said targeting parameters; (e) electronically prompting said first system and said second system via the advertisement request message to each send a coordination request message to a Coordination Hub, said coordination request message comprising information deduced from said confidential information regarding market participants in said first and second systems, wherein the selection of the information that is sent to the Coordination Hub is based at least in part on said first market participant's targeting parameters; (f) electronically prompting based on the coordination request message said Coordination Hub to issue permissions to advertise the order to selected market participants, wherein market participants are selected based, at least in part, on said received information regarding market participants; and (g) electronically prompting based on the permission to advertise the order said first system and said second system to route information about said order from first participant to said selected market participants.

Owner:ITG SOFTWARE SOLUTIONS INC

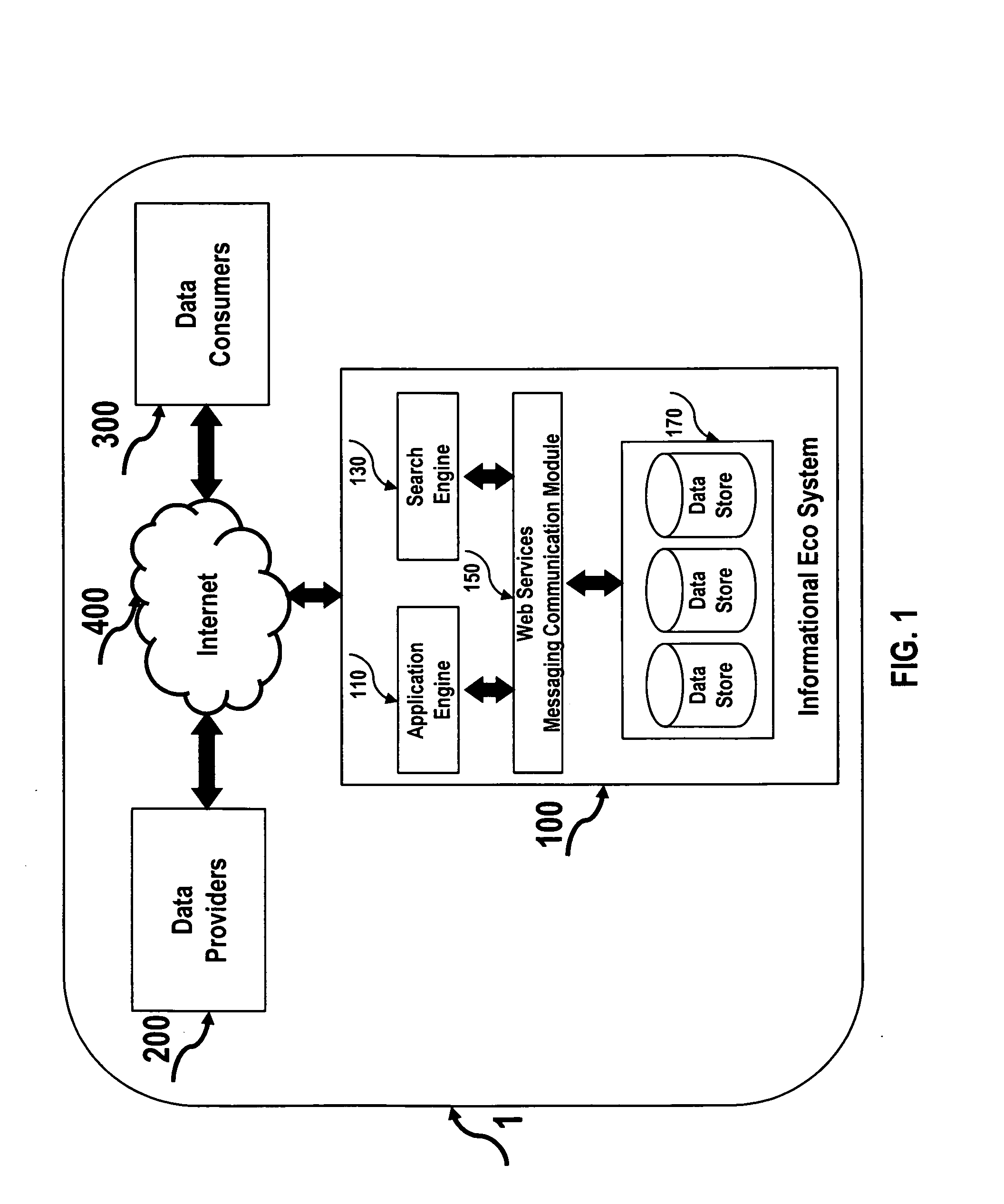

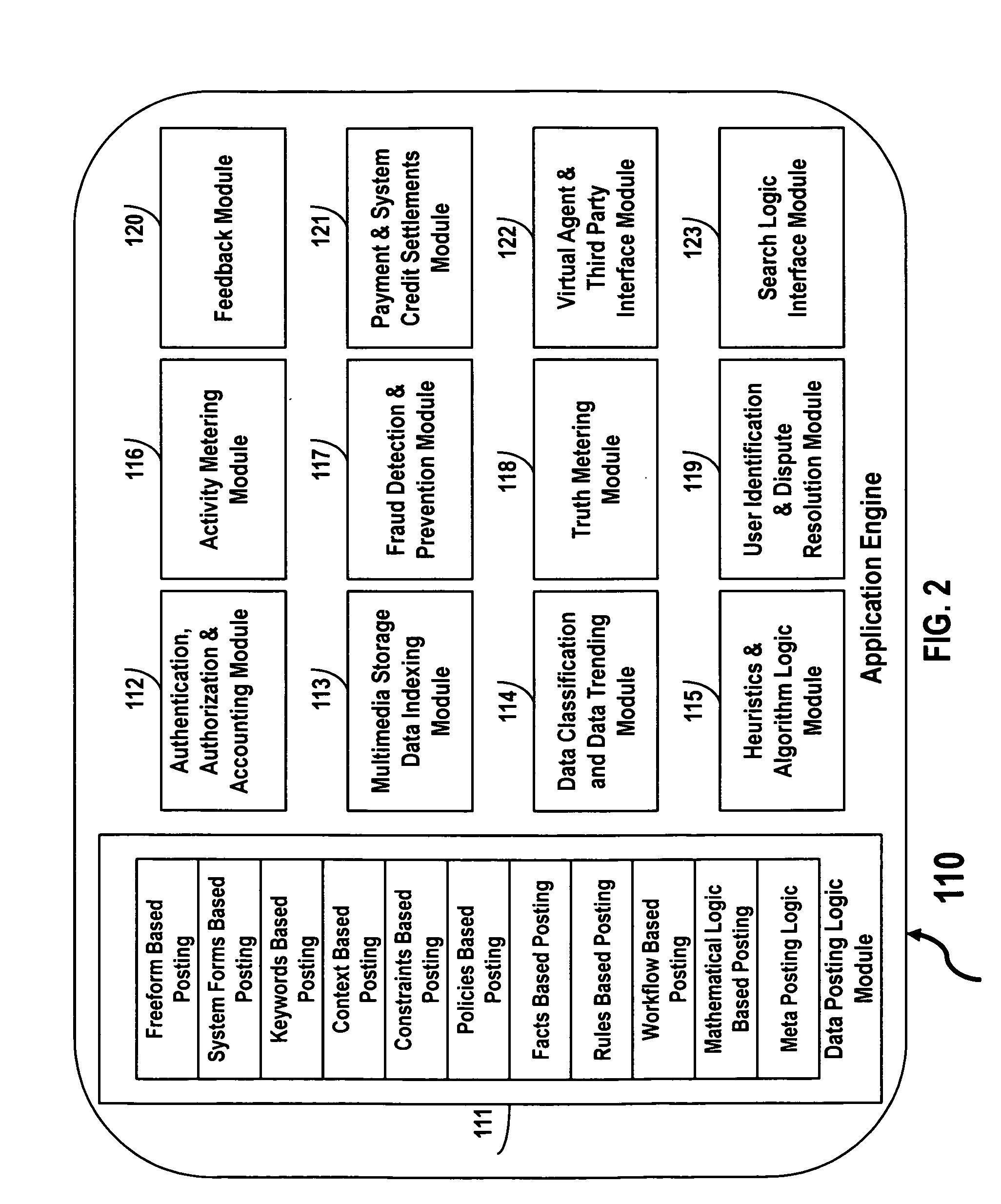

Internet eco system for transacting information and transactional data for compensation

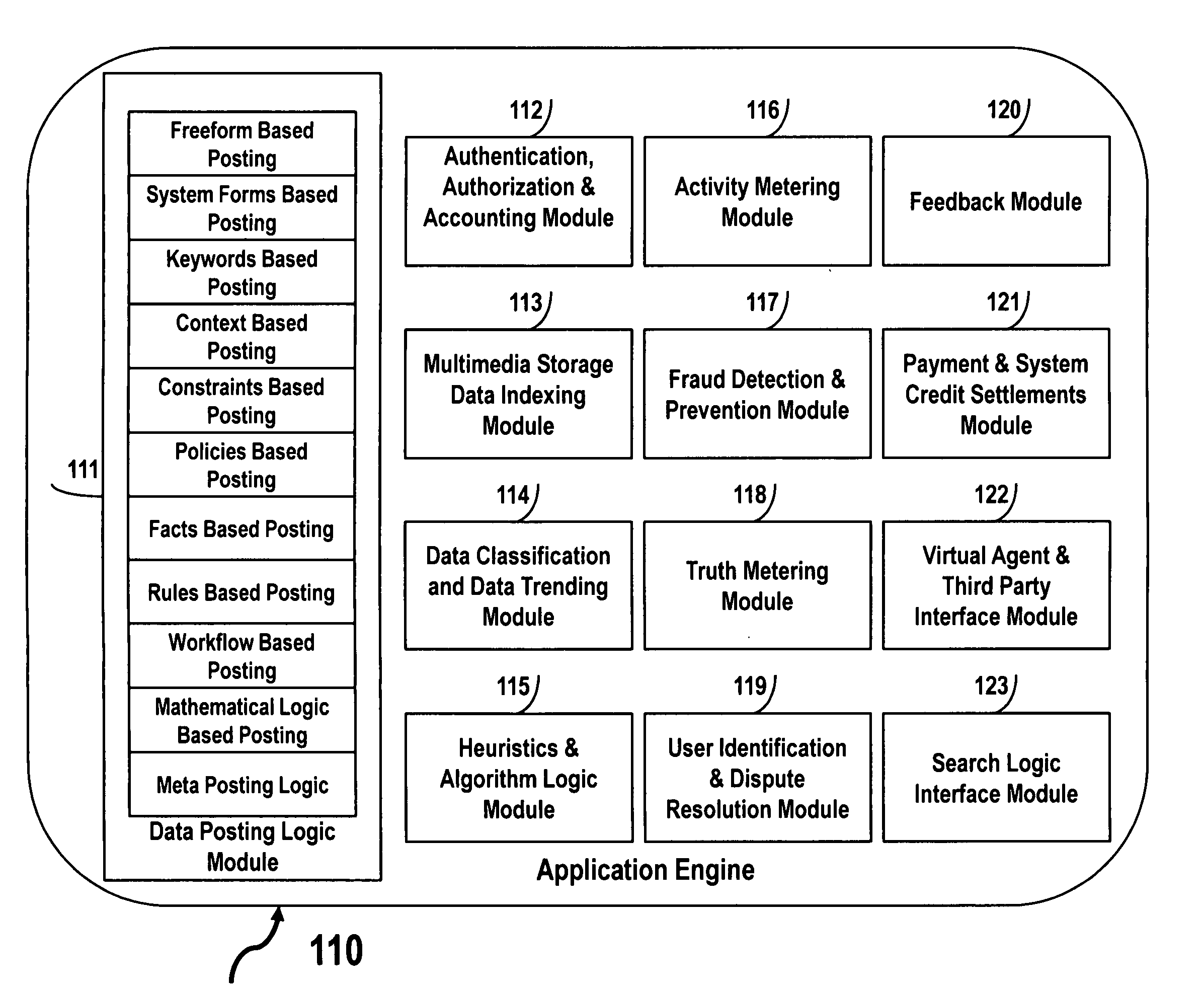

In one embodiment, an Internet eco system includes a data posting platform securely accessible over the Internet to post personal, confidential and business data for conducting informational and transactional transactions for compensation. In another embodiment, the Internet eco system enables data providers to earn monetary compensation, system credits compensation or barter based compensation. In another embodiment, the Internet eco system enables data posting based upon freeform, system forms, keywords, mathematical logic, constraints, policies, facts, rules, workflow, or context logic; such data can be searched and retrieved based upon keywords, mathematical logic, constraints, policies, facts, rules, workflow, or context based search criteria. In yet another embodiment, the Internet eco system provides methods for authentication, authorization, accounting, data indexing, data classification, heuristics, activity metering, fraud detection and prevention, user identification, verification and dispute resolution, providing feedback, payments and systems credit settlement, providing virtual agent capabilities and third party interfacing capabilities and for providing interfaces to search logic. In yet another embodiment of the Internet eco system provides methods for data providers and data consumers to engage in and to consummate social networking based transactions.

Owner:HADI ALTAF

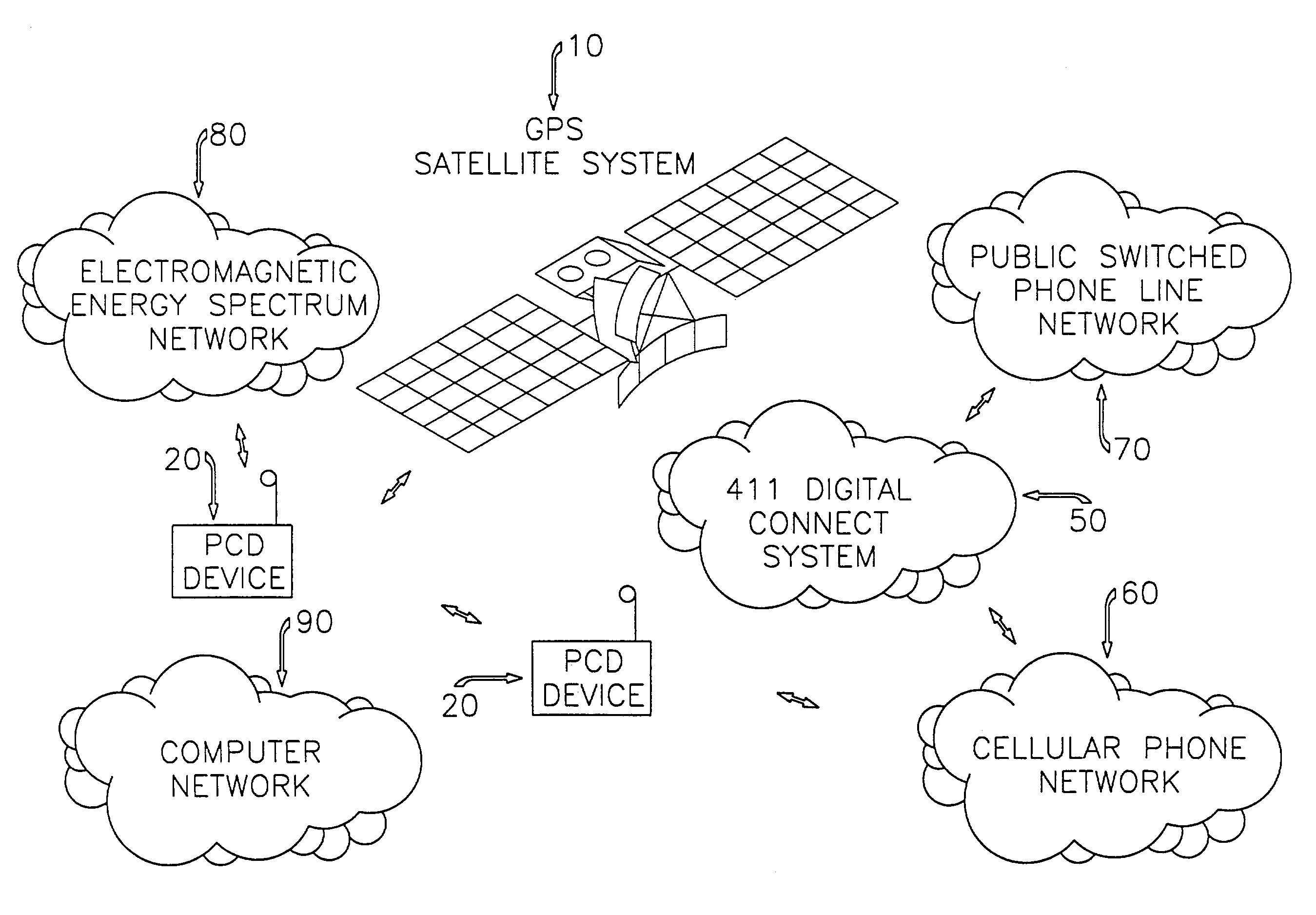

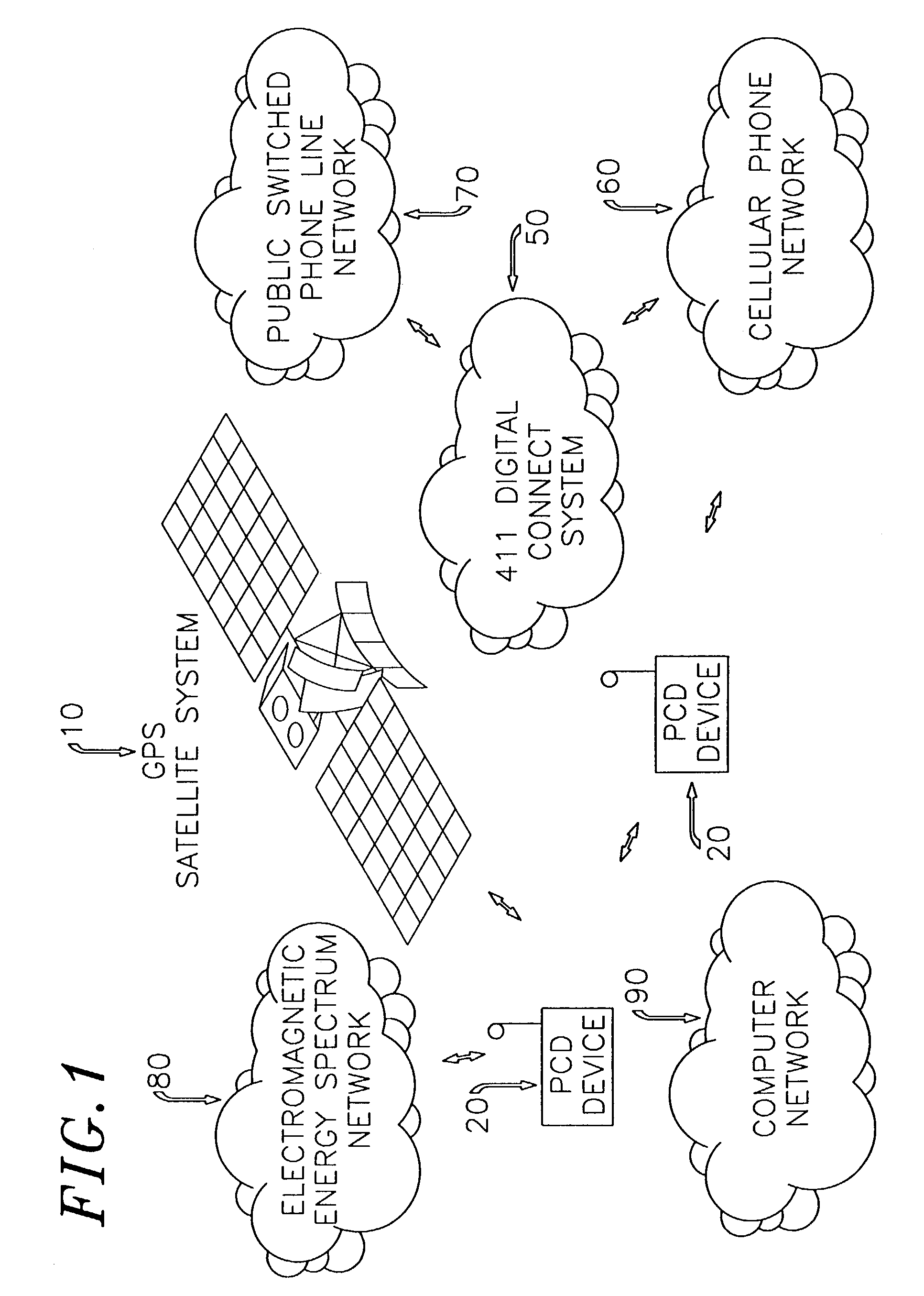

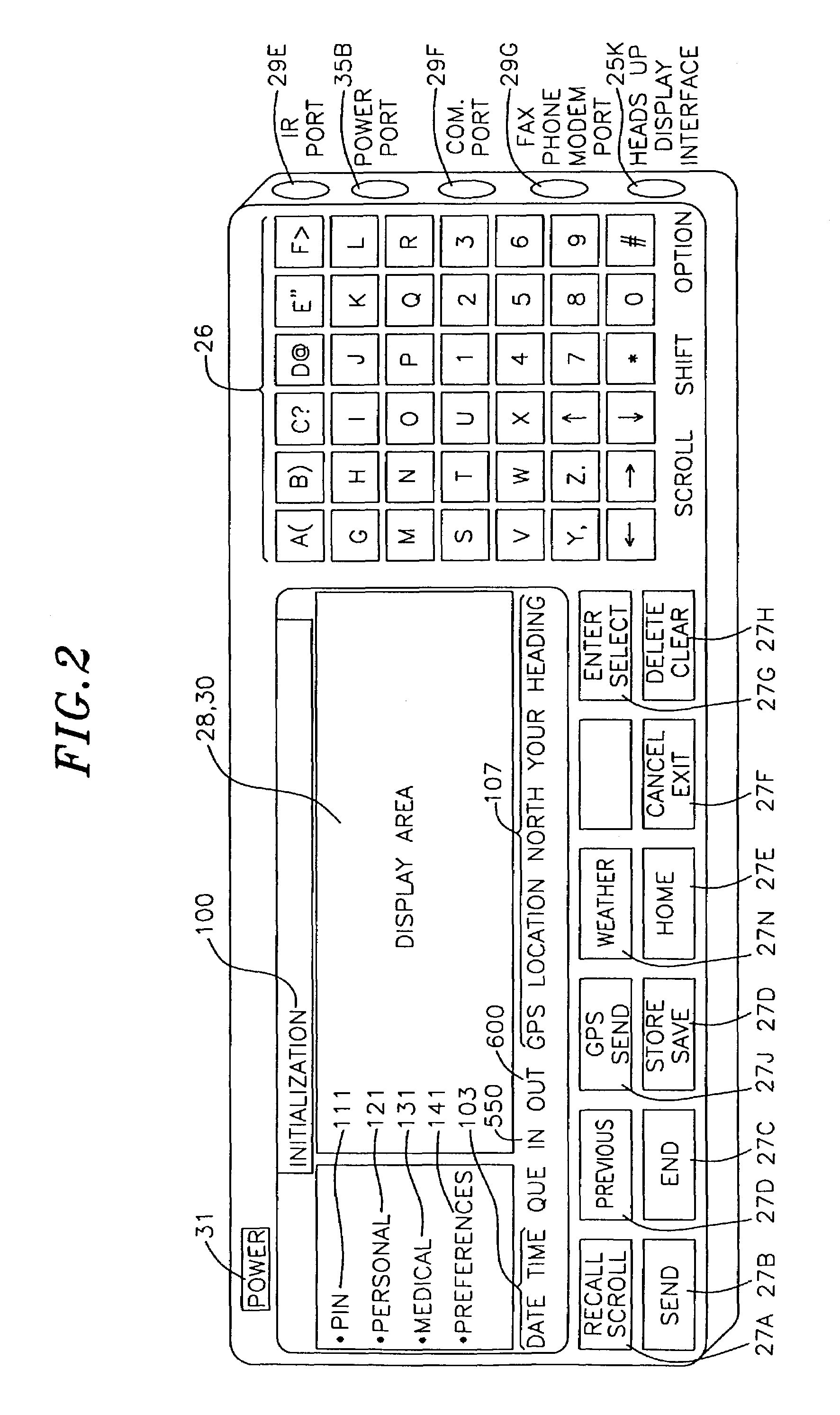

Positional camera and GPS data interchange device

InactiveUS7748021B2Reduce and eliminate needAnalogue computers for vehiclesTelevision system detailsData providerDisplay device

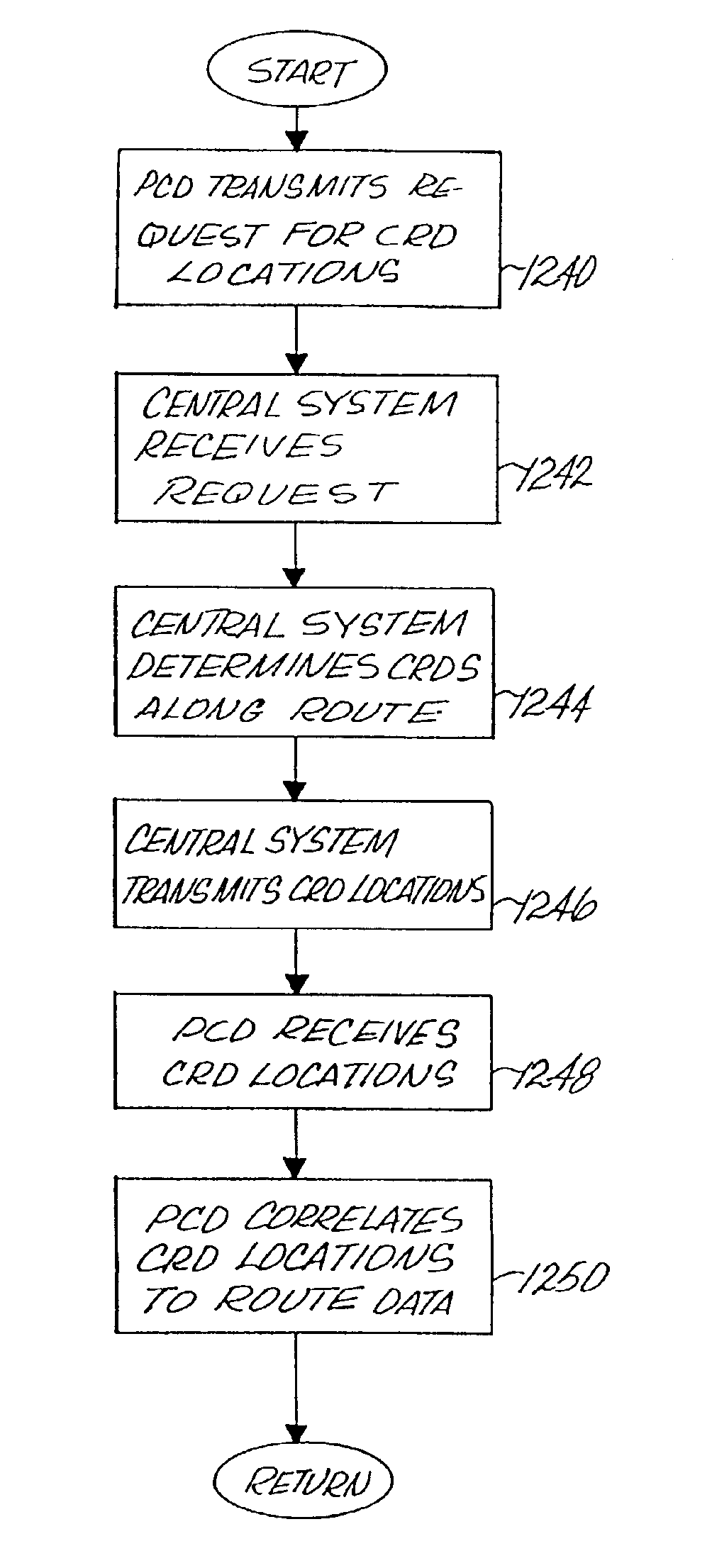

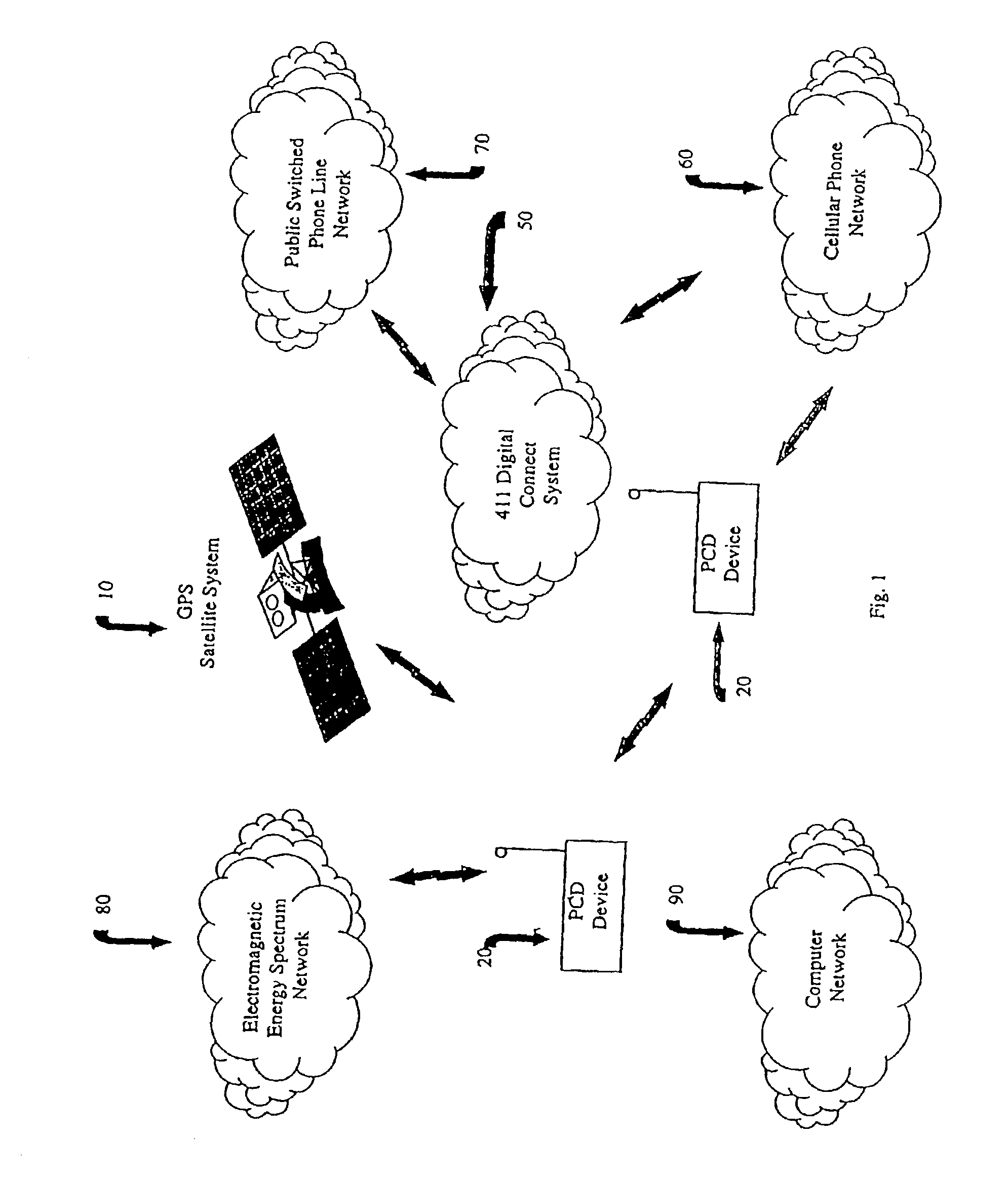

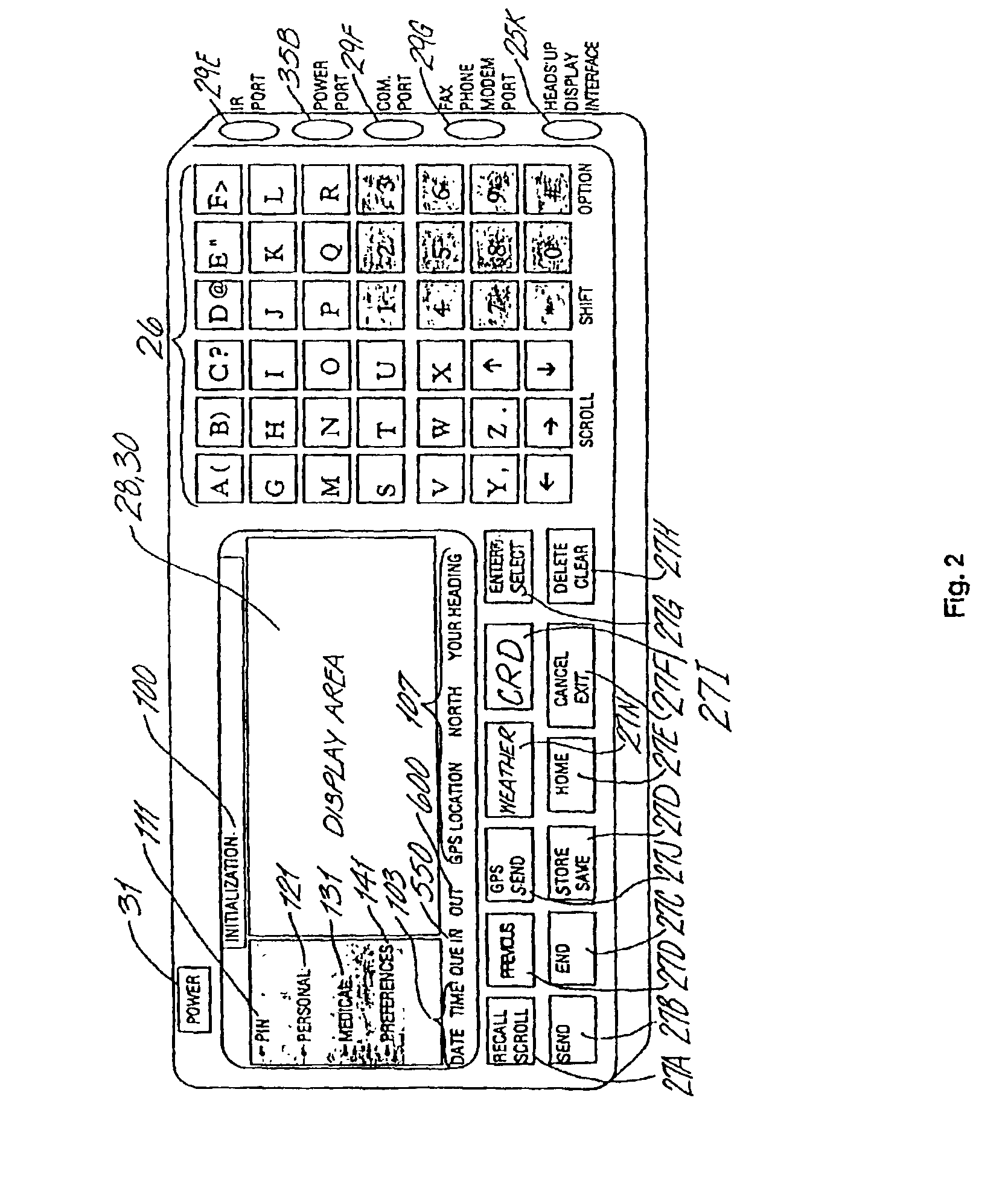

A location tagged data provision and display system. A personal communication device (PCD) with electromagnetic communication capability has a GPS receiver and a display. The PCD requests maps and location tagged data from data providers and other for display on the PCD. The data providers respond to requests by using searching and sorting schemes to interrogate data bases and then automatically transmitting data responsive to the requests to the requesting PCD.

Owner:SILVER STATE INTELLECTUAL TECH

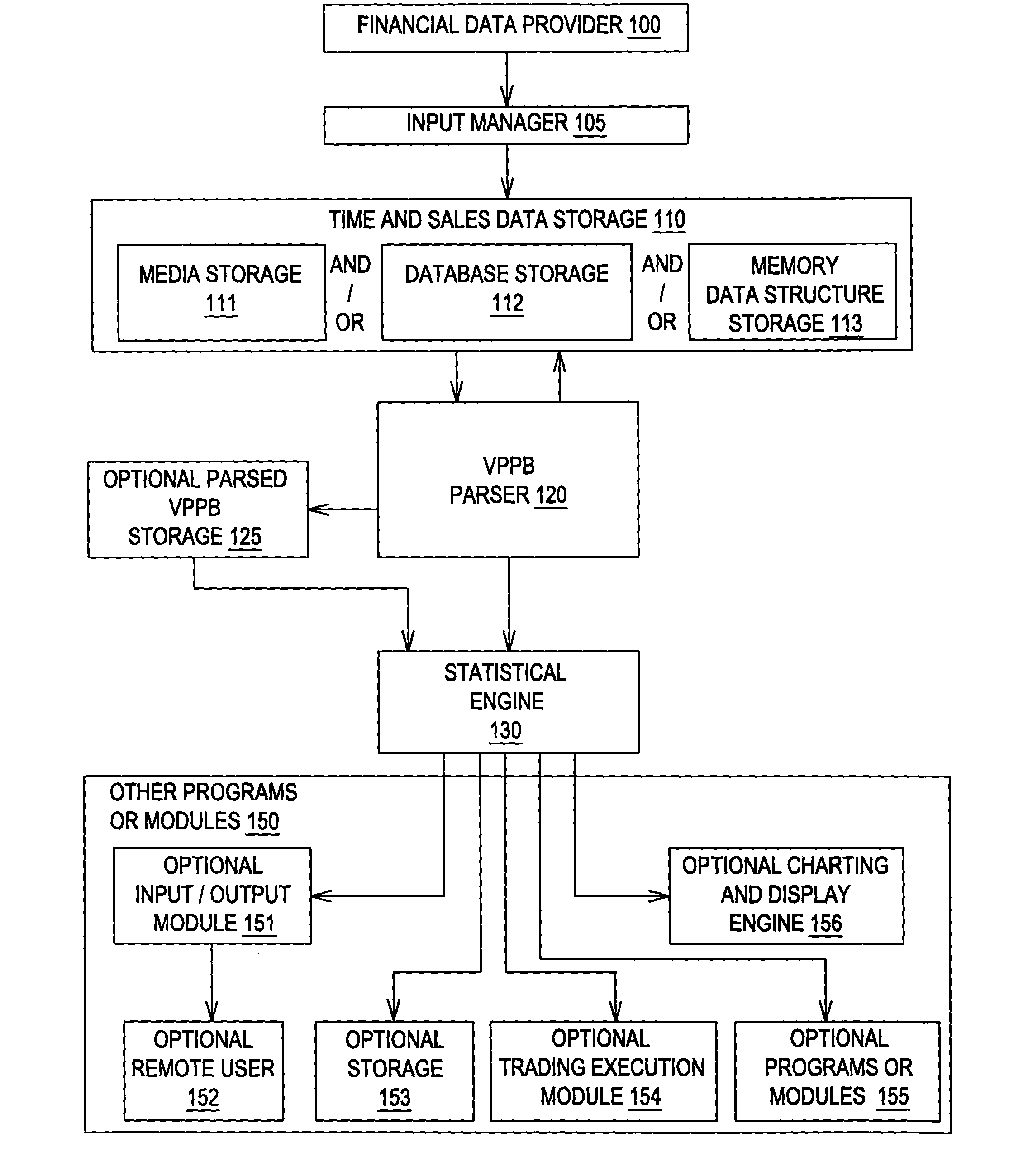

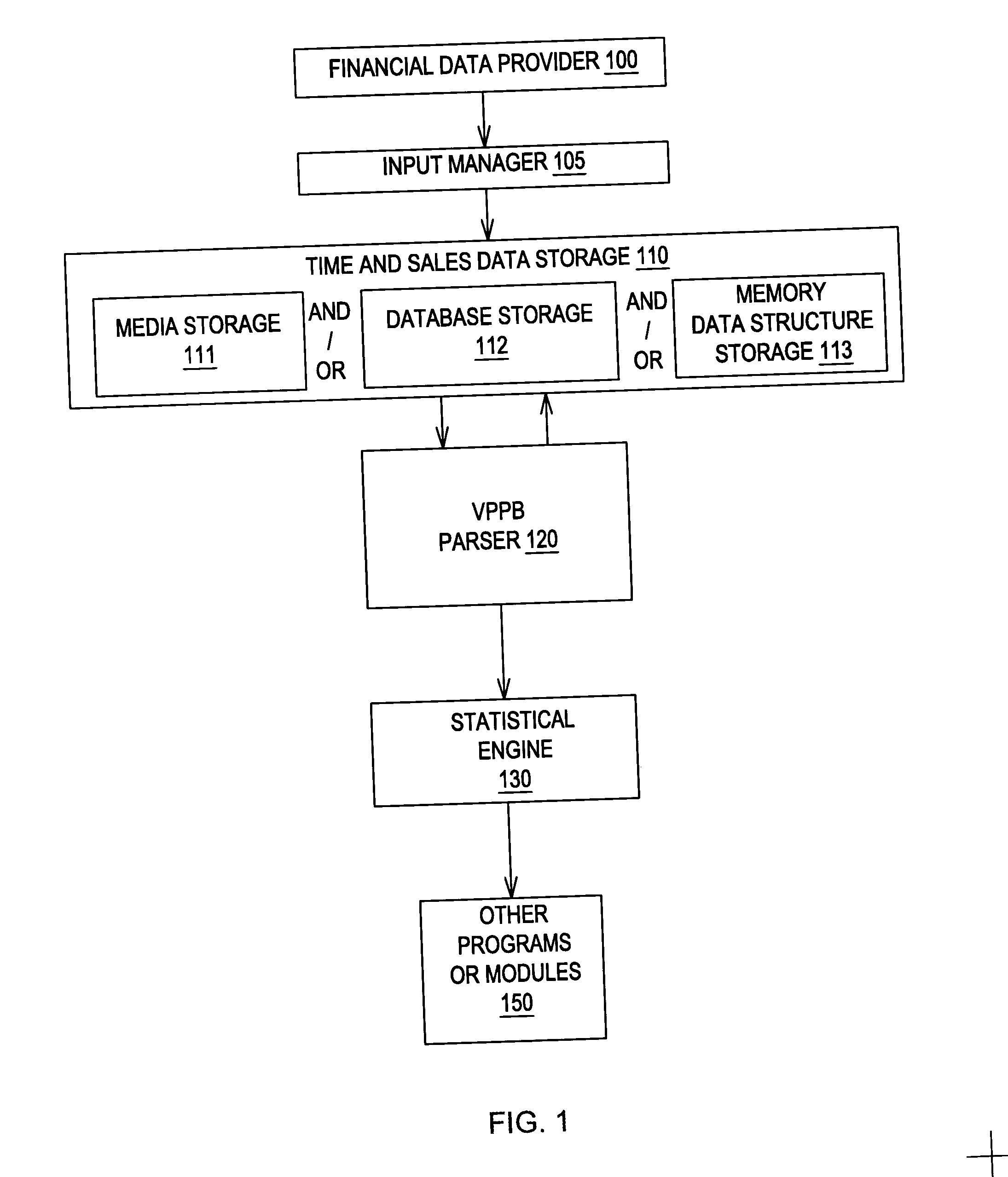

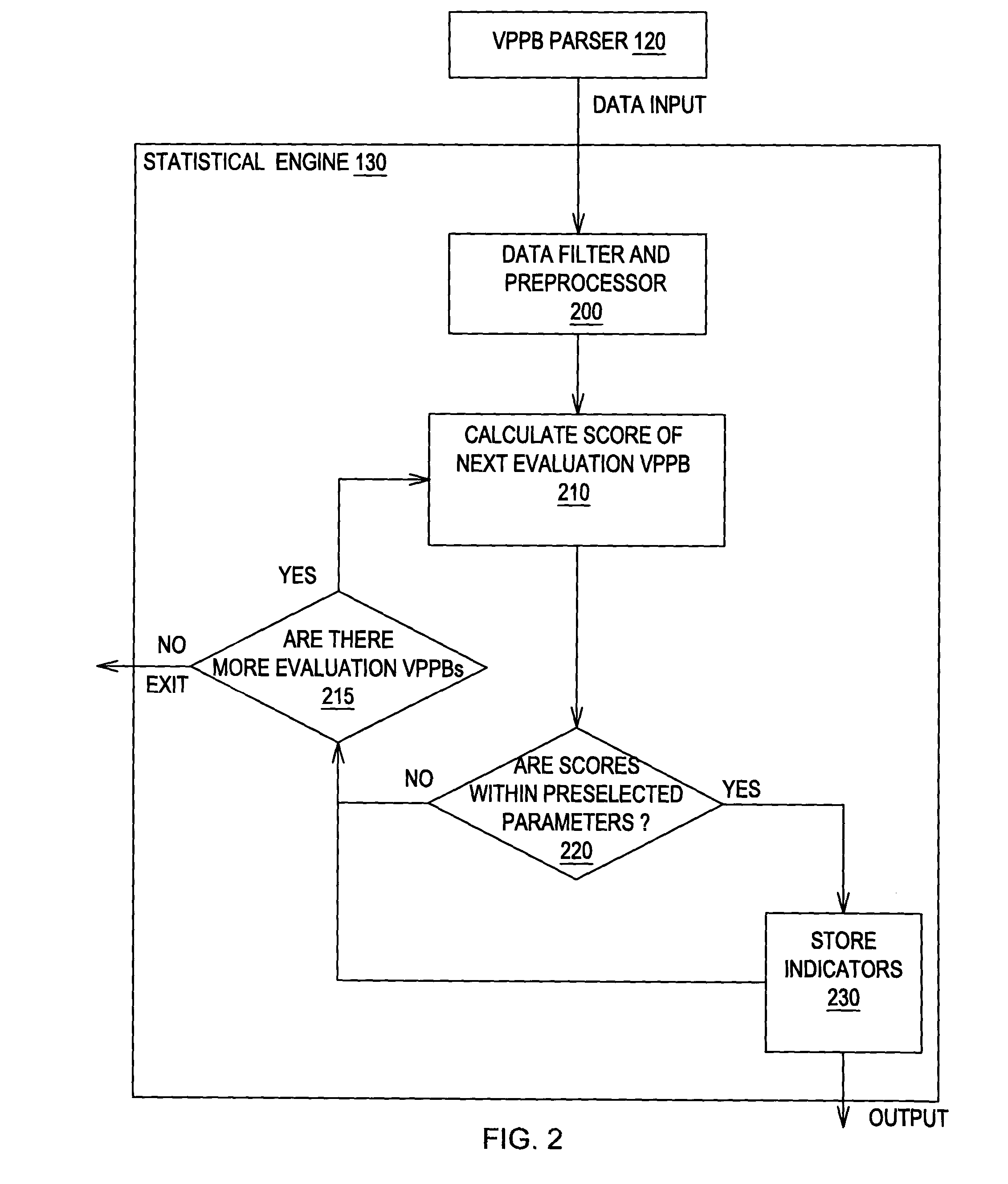

Computer Implemented Method and System of Trading Indicators Based on Price and Volume

InactiveUS20040225592A1UnderstandingEasy to optimizeFinanceDigital computer detailsTime lagData provider

A method and system for providing trading indicators for selected instruments traded in a market such as stocks, currency contracts, bonds, commodities contracts, options contracts, and futures contracts. The method and system create trading indicators using Time and Sales data as provide by exchanges or financial data providers. The method comprise parsing time, price and volume of individual transactions into a collection of volume per price bracket per time interval quantities, wherein each quantity is an aggregate volume of transactions executed during one of a set of sequential time intervals and executed at prices within one of a set of price brackets. The method generate trading indicators by using mathematical algorithms to score individual volume per price bracket per time interval quantities corresponding to an evaluation time interval against a population of individual volume per price bracket per time interval quantities corresponding to a set of previous time intervals. The system generates trading indicators in real time, without the time lag associated to traditional technical analysis indicators. The method and system can also generate trend indicators based on analysis of volume accumulation, and defines trading indicators based on maximum volume prices.

Owner:CHURQUINA EDUARDO ENRIQUE

Audience server

ActiveUS20050246736A1Enhanced content deliveryReduce deliveryTelevision system detailsBroadcast systems characterised by addressed receiversData providerTime factor

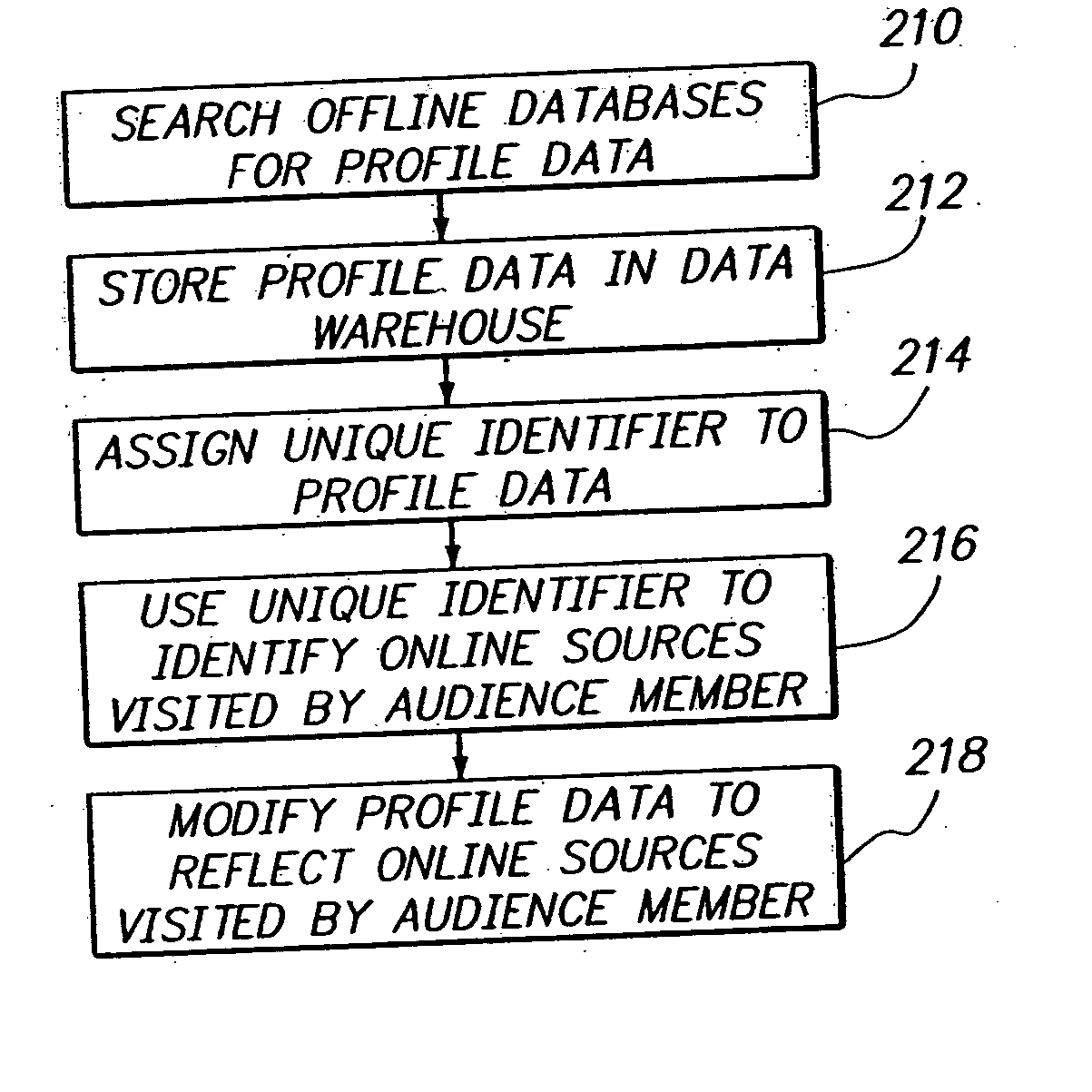

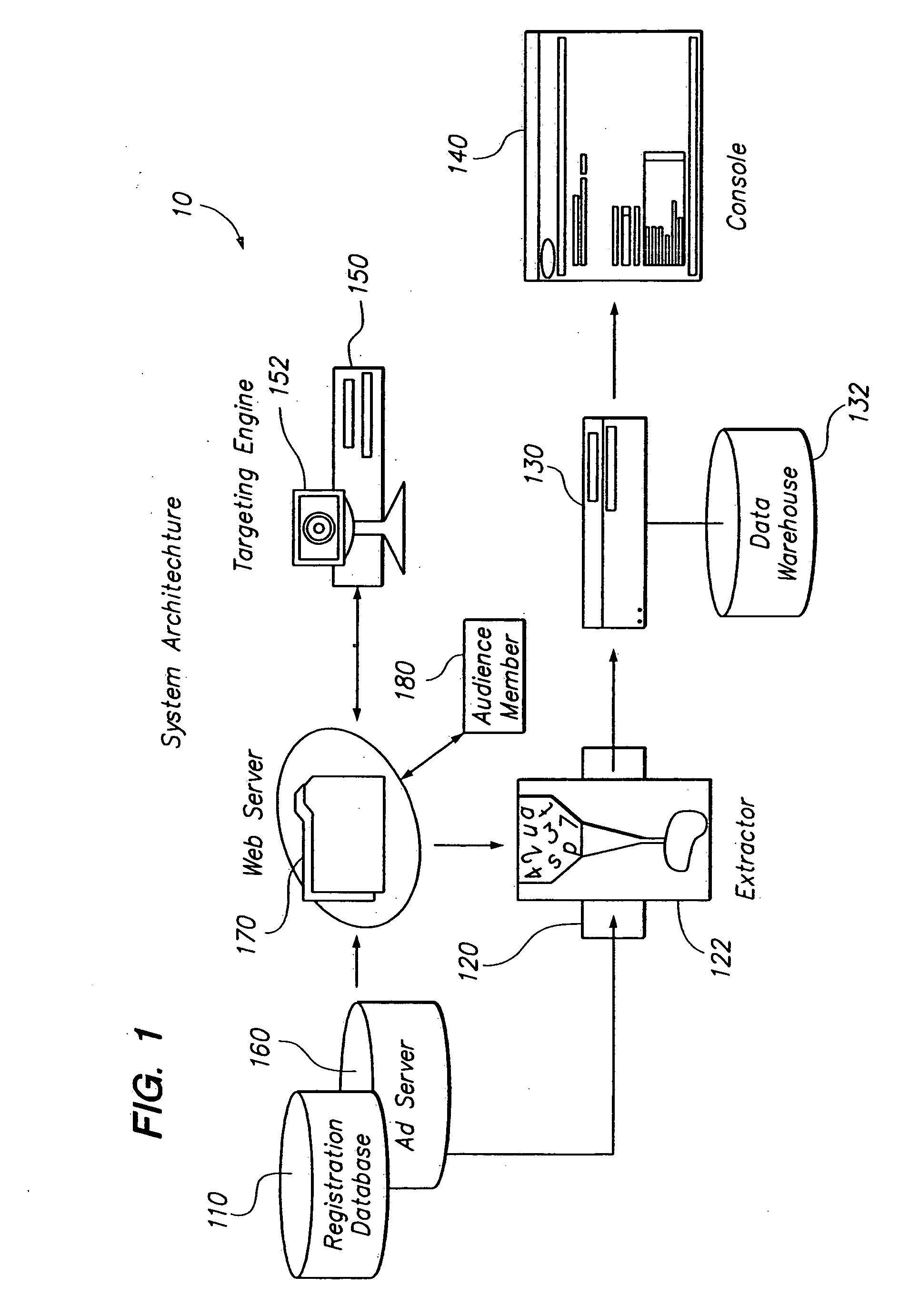

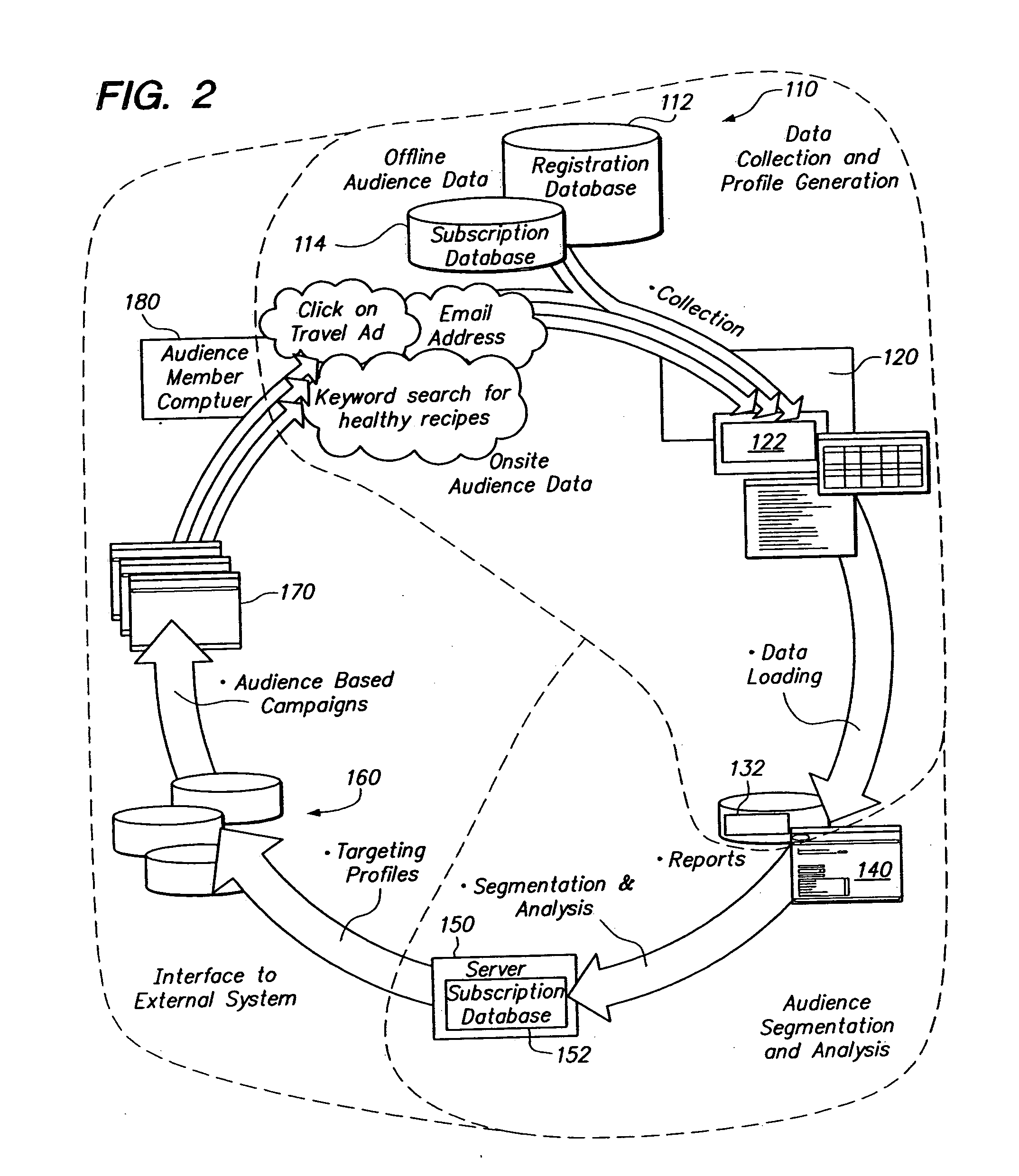

Delivery of content such as advertisements to audience members. Profile data is collected regarding audience members to whom advertisements may be delivered, such that a given audience member has an established profile data. Upon receiving a request to serve an advertisement to an audience member, a recognition that the target of the request is the given audience member is made. Then it is determined that a particular advertisement should be served to the given audience member. The determination includes recognition of the given audience member and corresponding selection advertisements optimized for the recognized audience member. A configurable delivery decision making mode allows pre-optimized as well as delivery time factoring for determining advertisements. Performance criteria and revenue allocation based upon data provider participation are also provided.

Owner:YAHOO AD TECH LLC

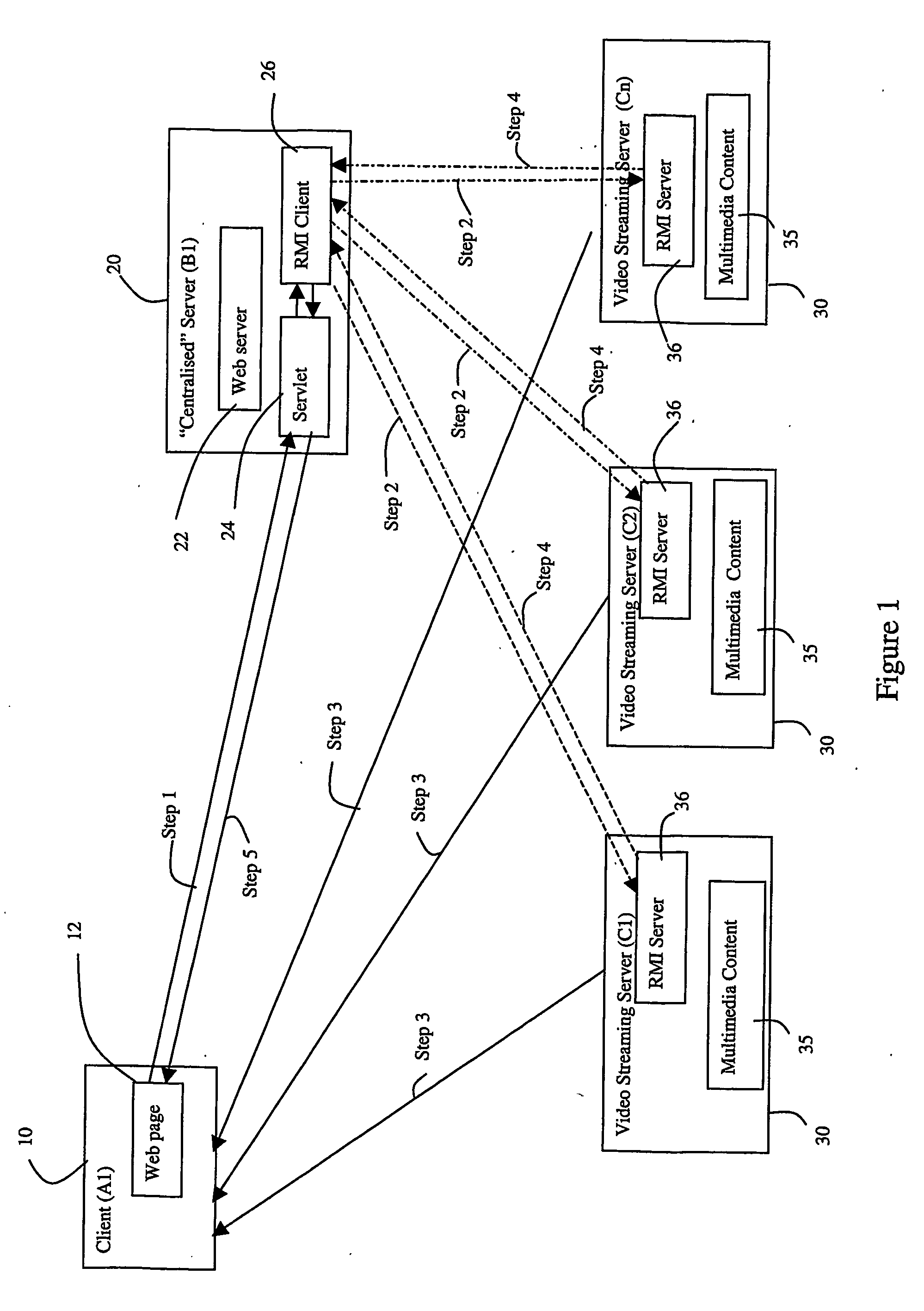

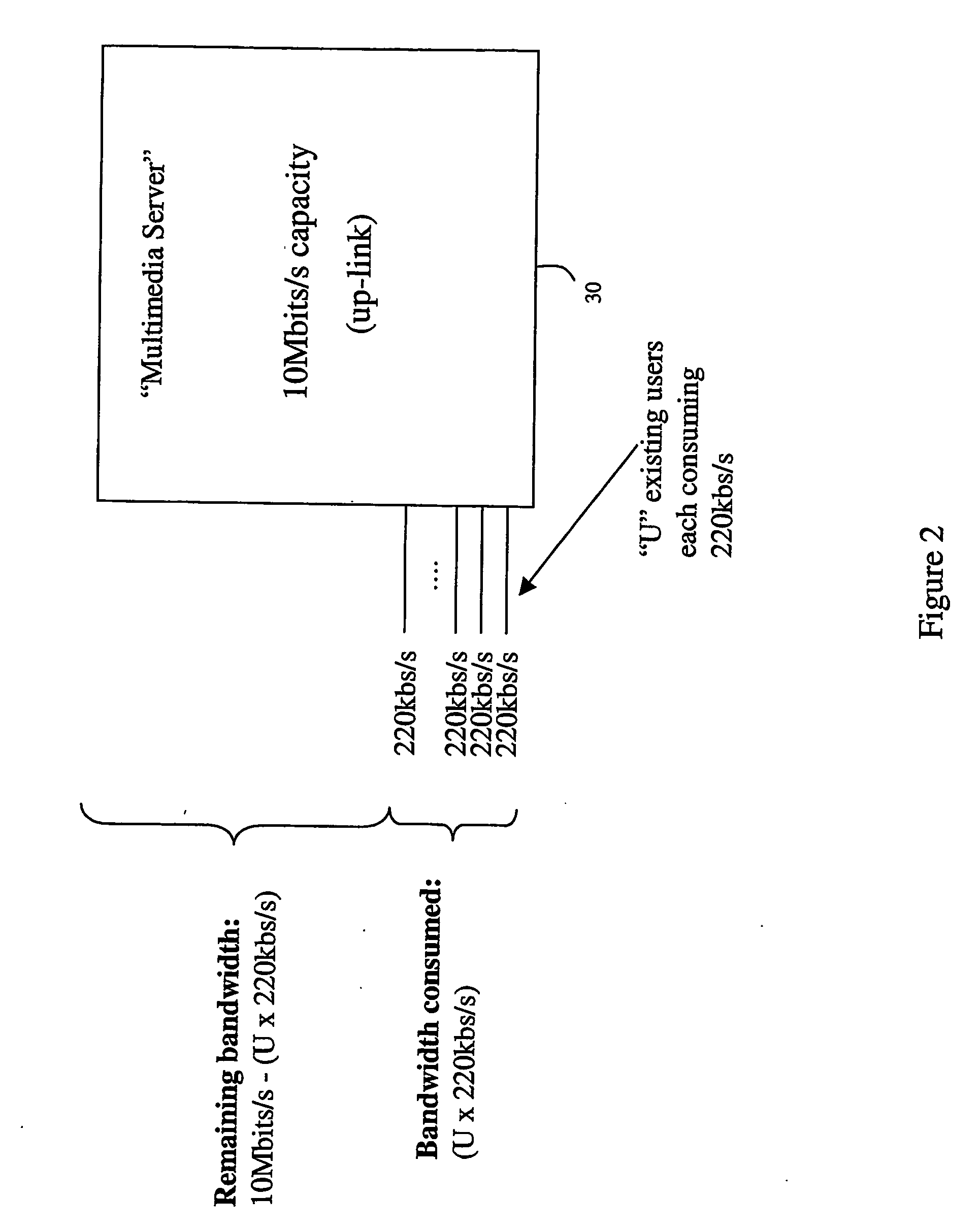

System and method for selecting data providers

ActiveUS20060245367A1Improve experienceError preventionFrequency-division multiplex detailsData providerClient-side

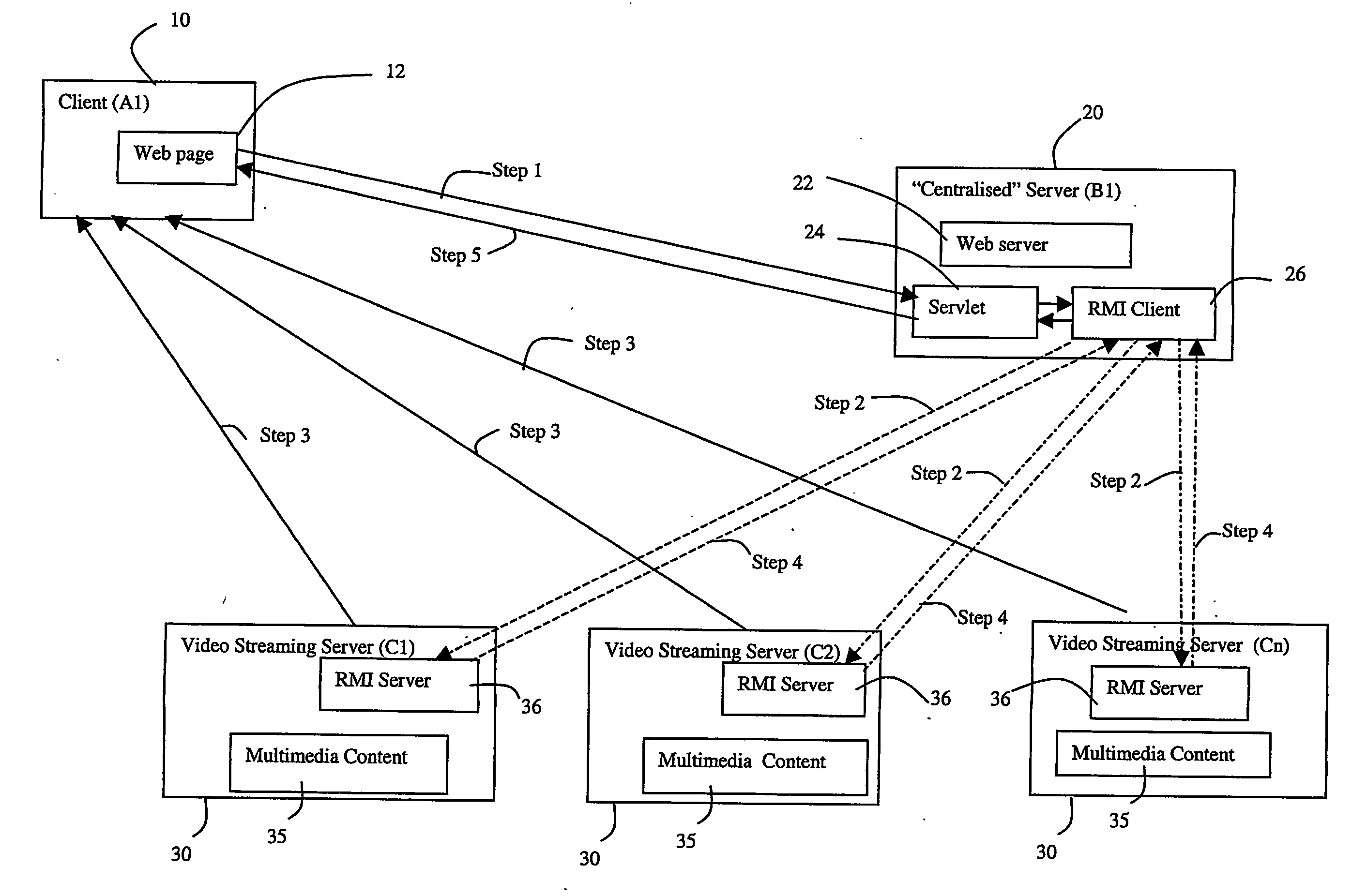

A system (20) and method by virtue of which a preferred data provider is selected from a plurality of data providers (30) by performing the steps of receiving a request for data from a client (10) together with client identification data, identifying a plurality of data providers (30) capable of providing data to the client (10), providing the client identification data to the data providers and instructing the data providers to perform tests in order to establish a measure of the elapsed time for a signal to be sent to and received from the client, and a measure indicative of their remaining capacity for data transfer, and to make these measures available to the system (20). One or more preferred data providers (30) may then be selected on the basis of the elapsed time signals and the remaining capacity signals from said data providers.

Owner:BRITISH TELECOMM PLC

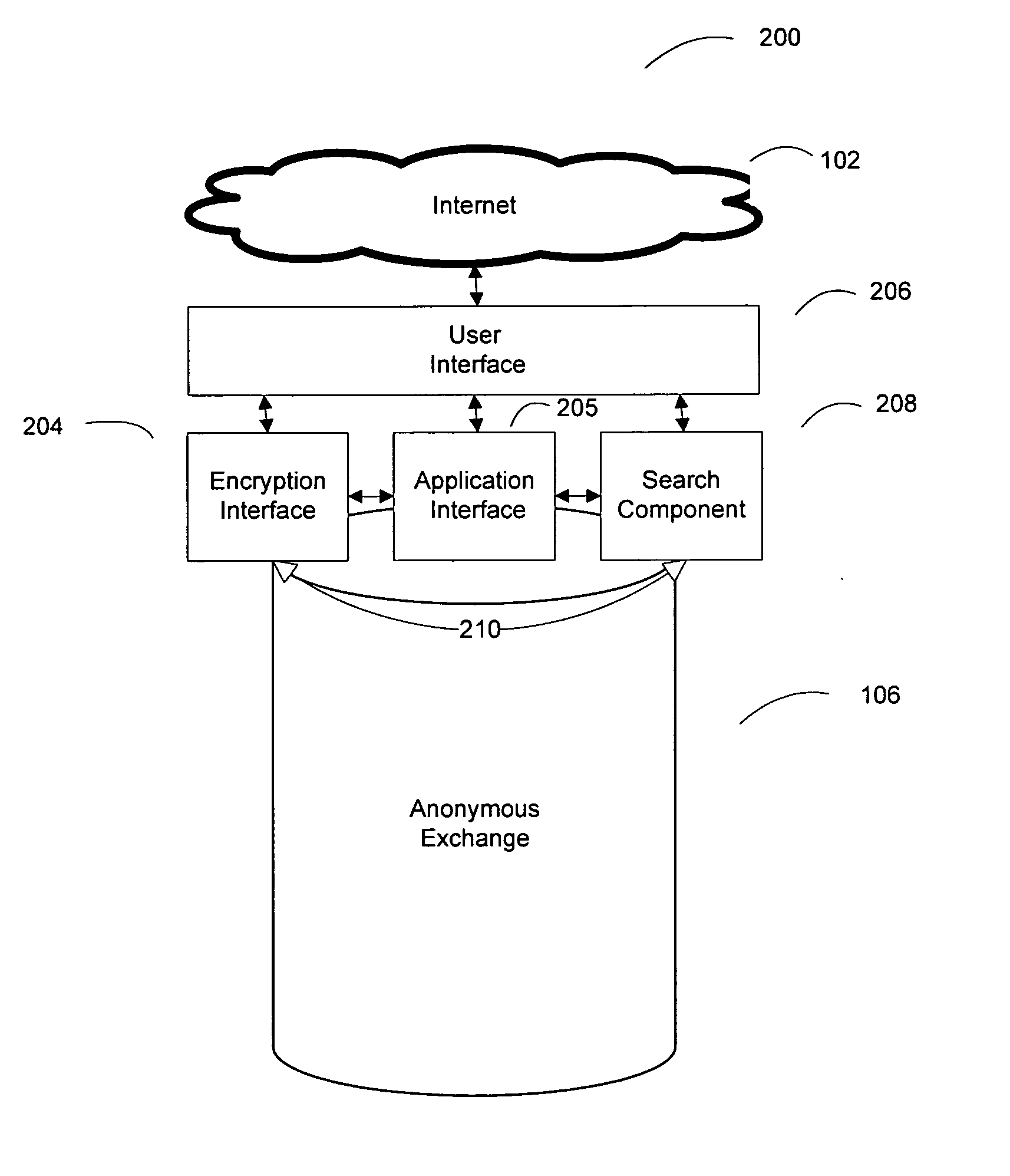

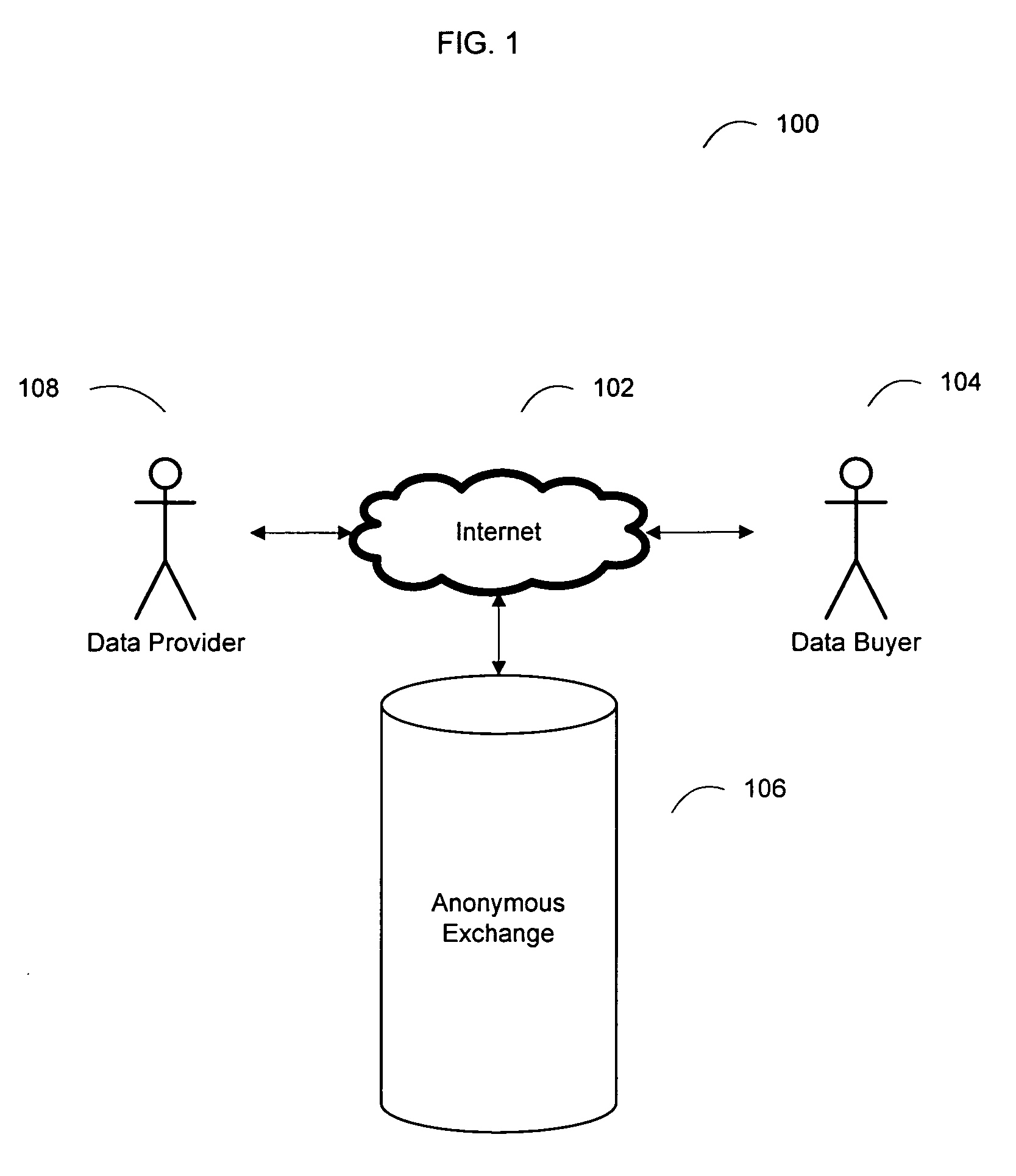

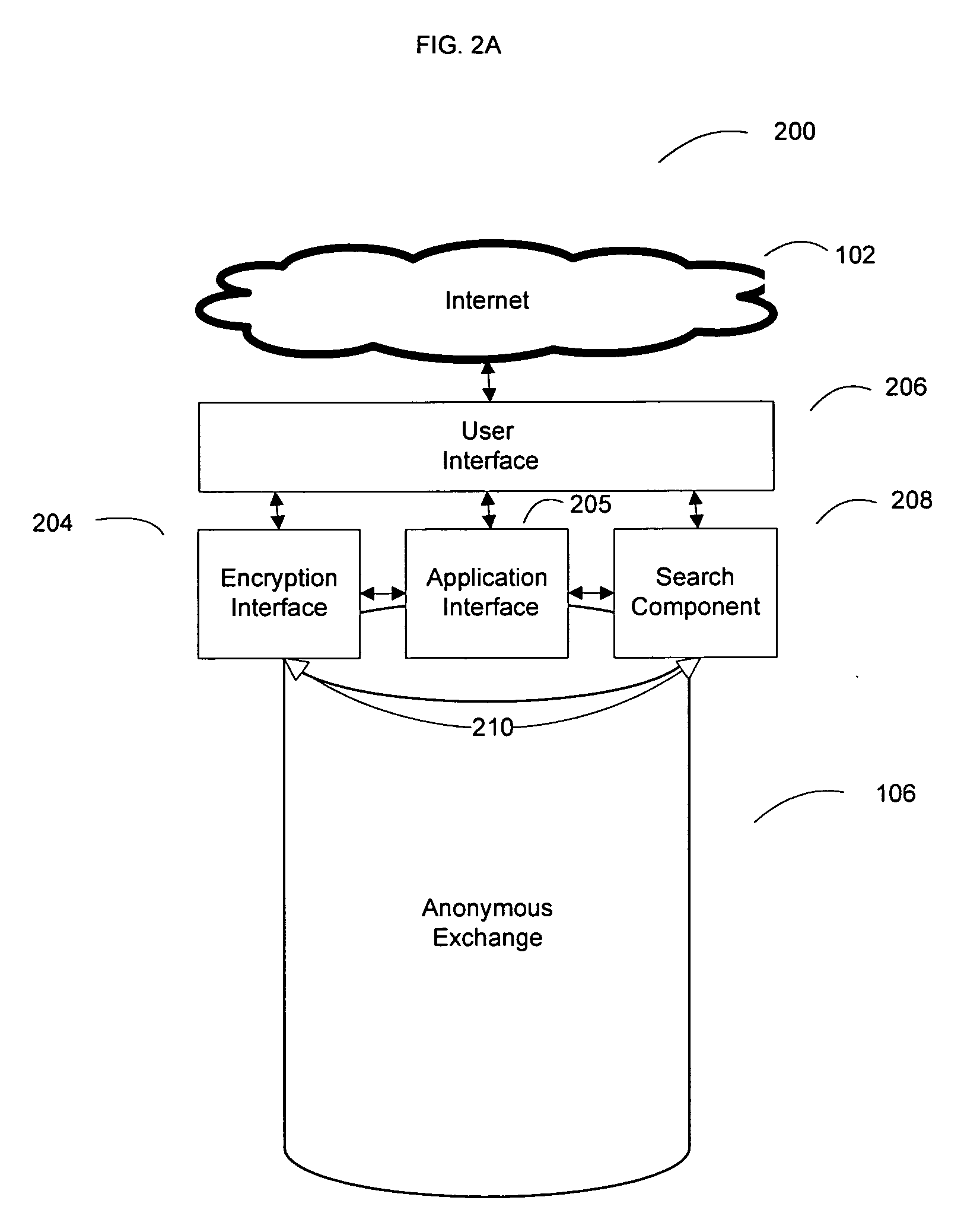

System and method for an anonymous exchange of private data

ActiveUS20070130070A1Meet the requirementsEasy accessPublic key for secure communicationComputer security arrangementsPaymentInternet privacy

Owner:CREDIGY TECH

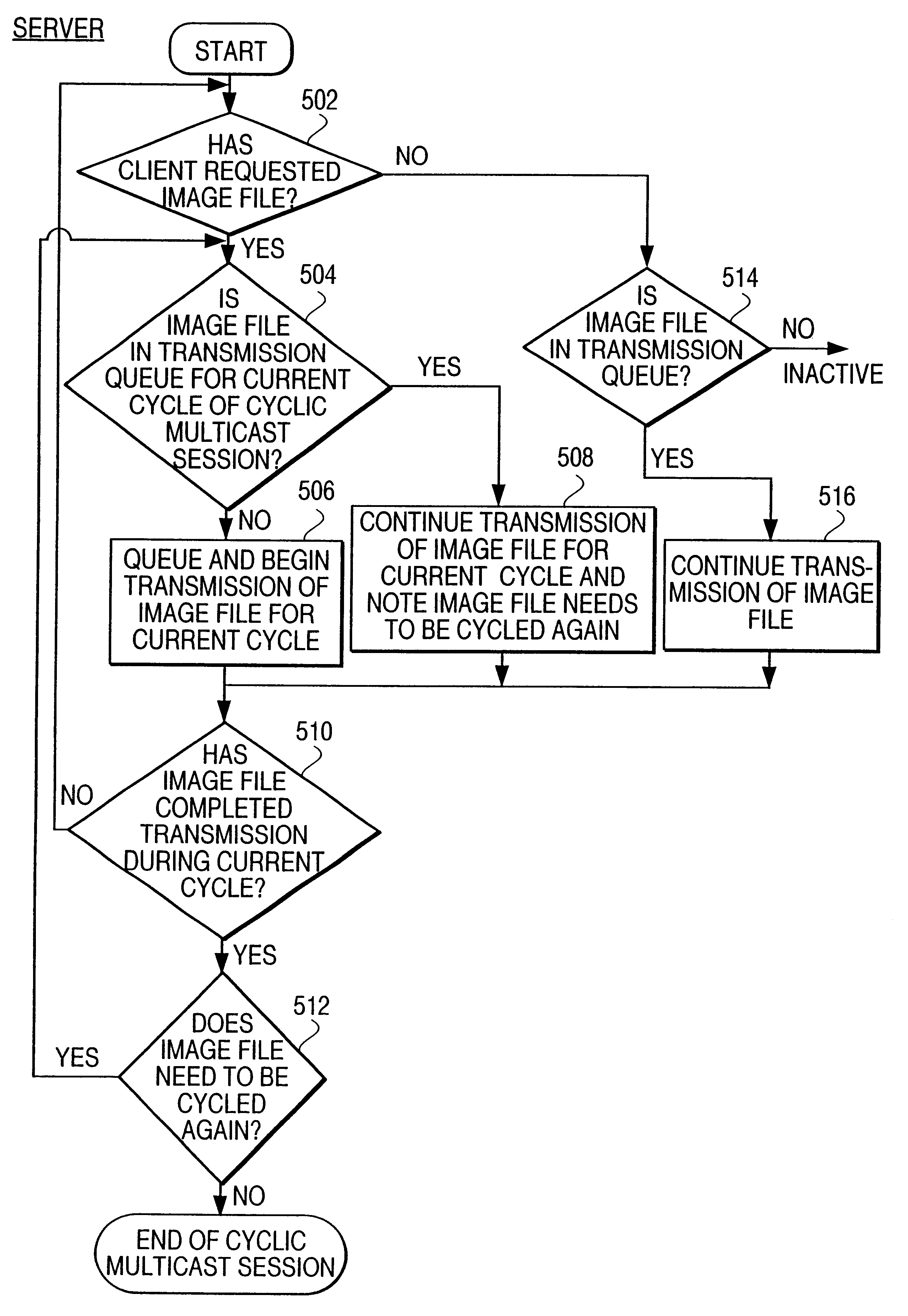

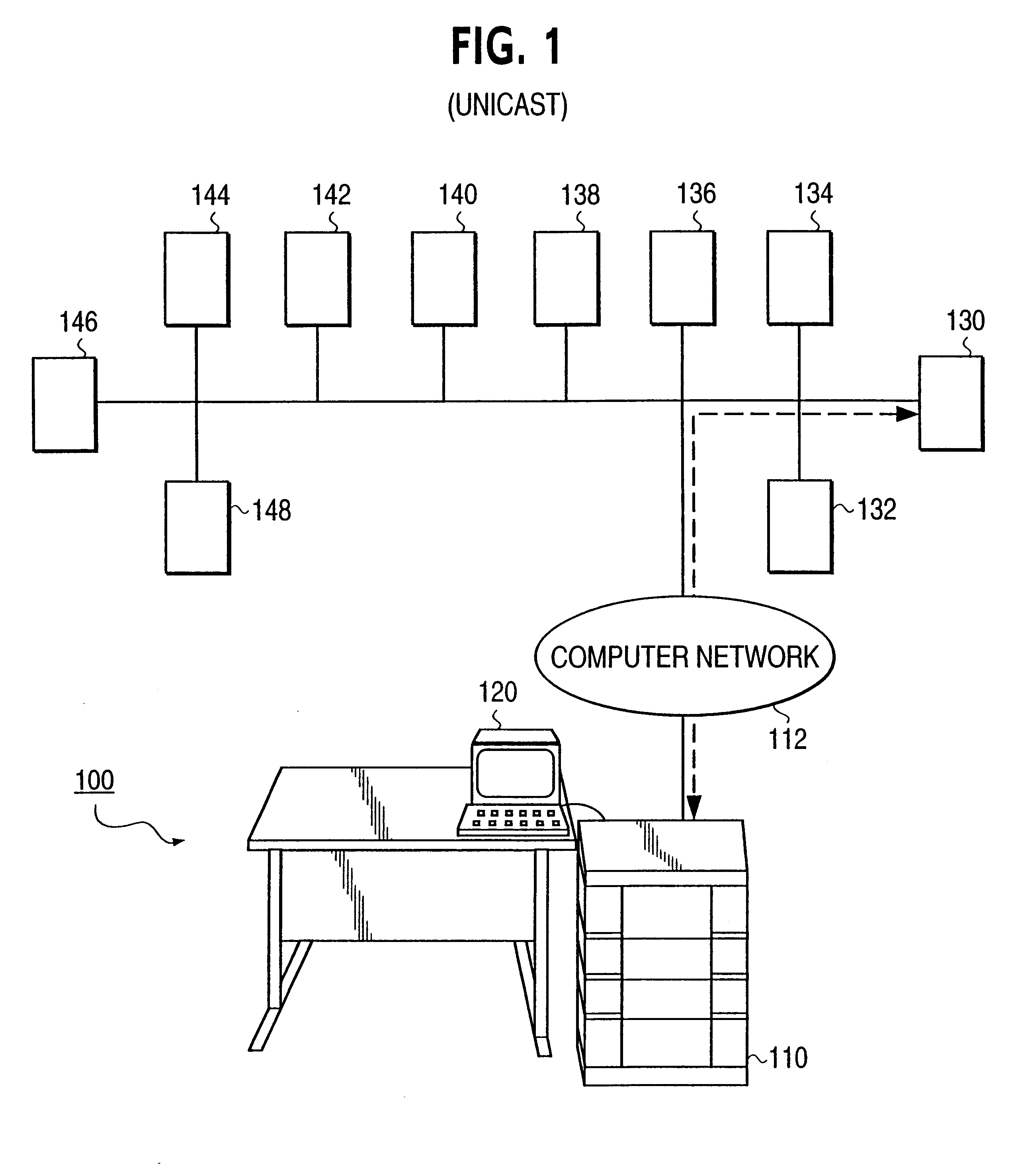

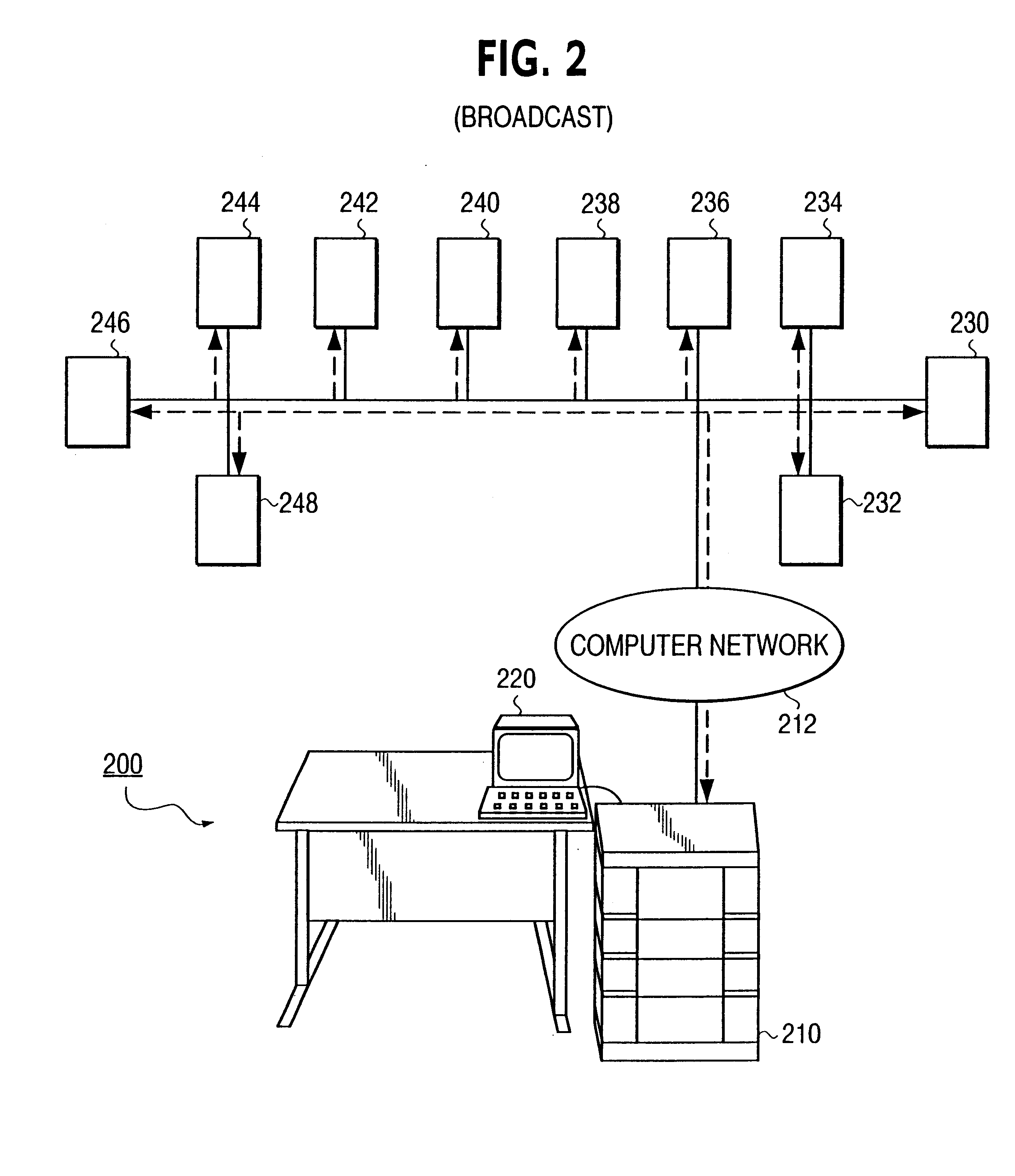

Cyclic multicasting or asynchronous broadcasting of computer files

InactiveUS6256673B1Special service provision for substationMultiple digital computer combinationsData providerNetworked system

A client / server network system is disclosed for cyclic multicasting of an image file from a central data provider (server) to one or more remote client machines (workstations) over a computer network with minimum network transmission while allowing any number of client machines (workstations) to download the image file at any moment in time without the need to synchronize with the central server's transmission. The network system includes a computer network; a plurality of remote client machines on the computer network; and a central server for providing a cyclic multicasting of an image file to one or more client machines over the computer network concurrently through the use of different transmission cycles of a single cyclic multicast session. An image file is asynchronously transferred from the central server to one or more remote client machines concurrently over a computer network through the use of different transmission cycles during a single cyclic multicast session so as to keep the network transmission and network bandwidth to a minimum.

Owner:MICRON TECH INC

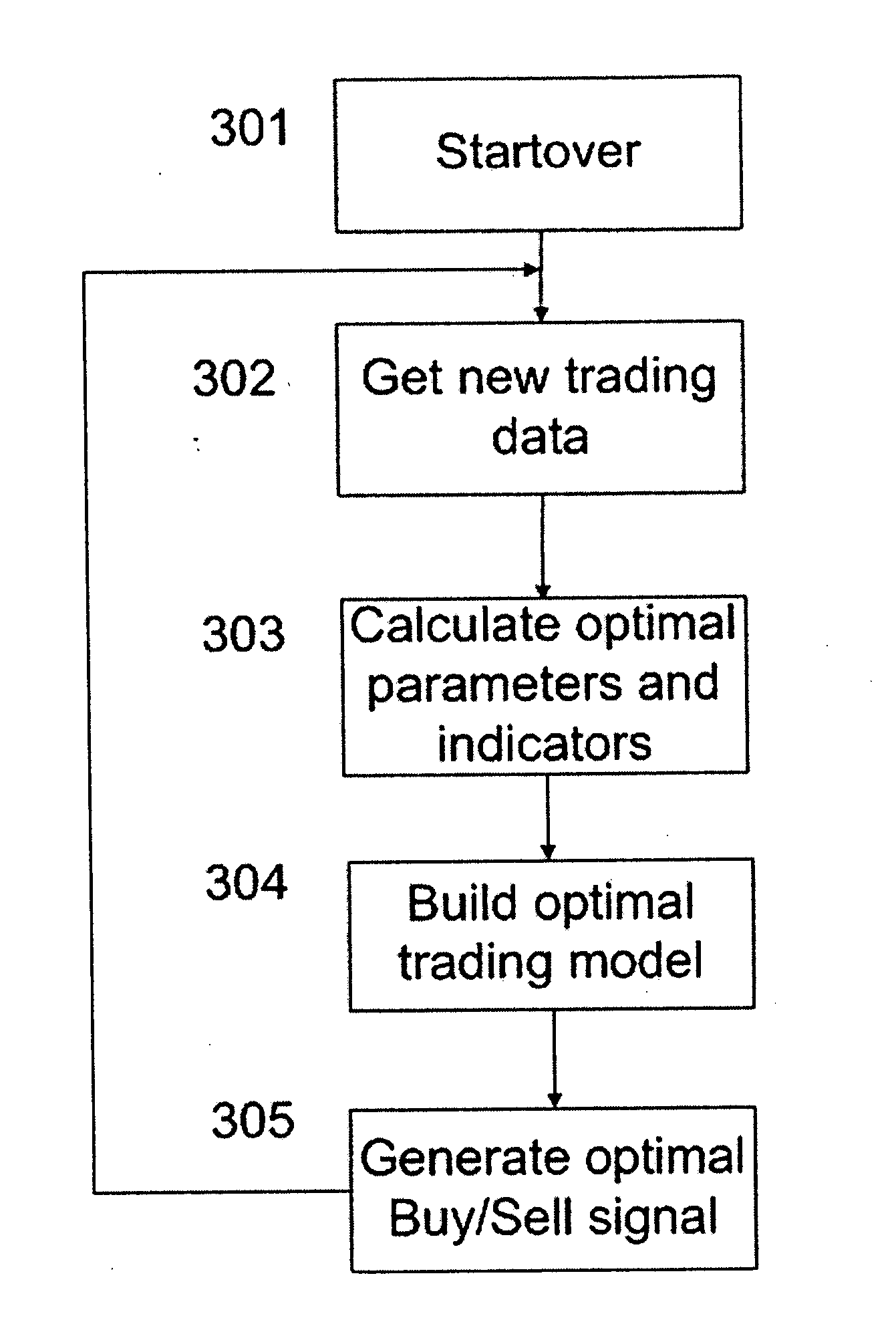

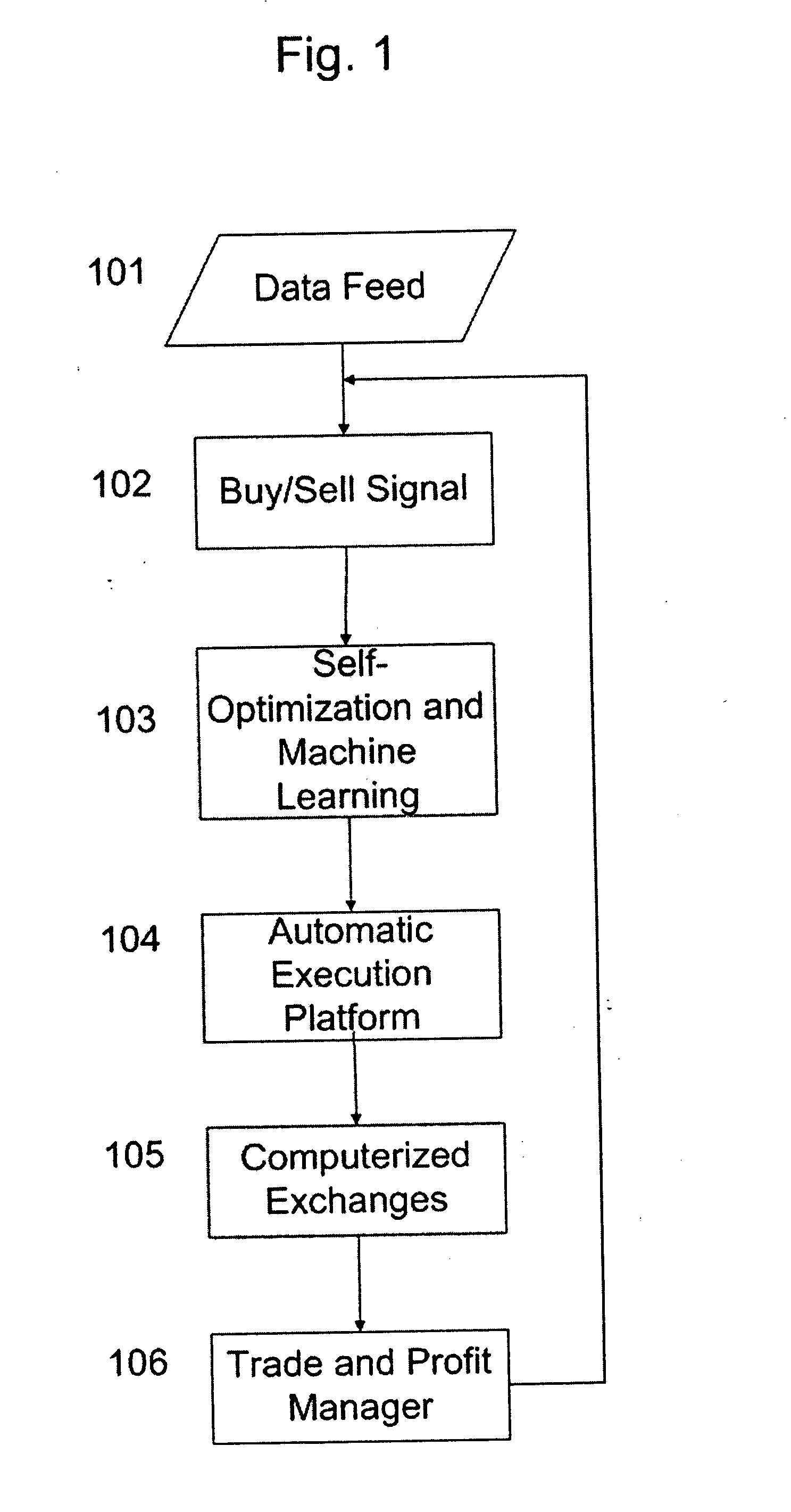

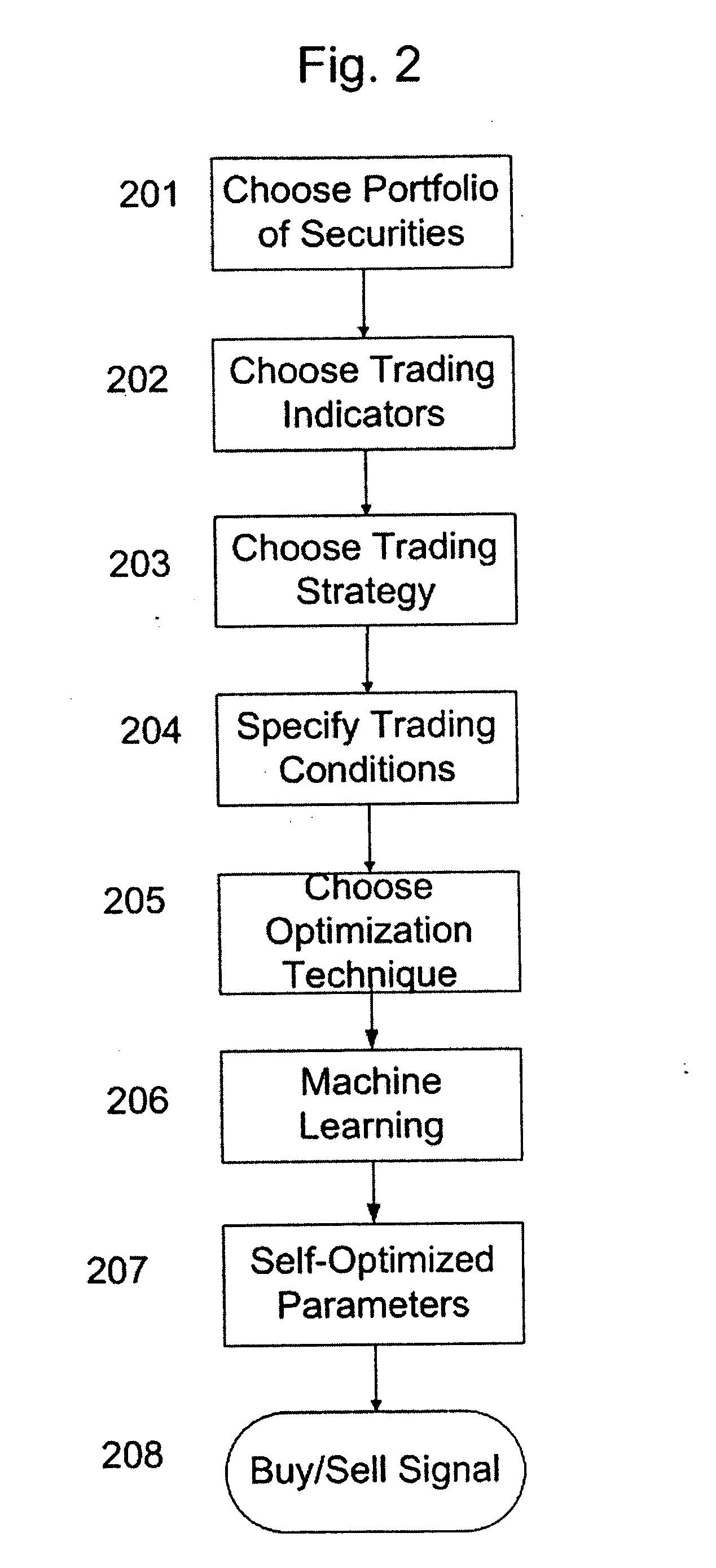

Machine learning automatic order transmission system for sending self-optimized trading signals

InactiveUS20050015323A1FinanceSpecial data processing applicationsData providerFinancial transaction

The invention is a Machine Learning system, method and computer program for automated transmission of Buy / Sell orders generated according to self-optimized trading parameters. Optimization could be performed according to every optimization method used. Perpetual real-time optimization (or self-optimization) of trading parameters adds Machine Learning feature to the invention. The invention provides a centralized trading system for the individual user or organization that wants to perform his trading automatically and completely without human intervention from receiving the data from the central server provider to real-time order execution in computerized financial markets. The disclosed system is integrated into a network of brokers, banks and other institutions trading on computerized markets. The system receives real-time market quotes information from a data provider remote server and uses it as an input for the defined trading strategies. These trading strategies generate Buy / Sell signals for a plurality of chosen market securities. The trading could be performed with previously optimized parameters or, alternatively, the optimization could be performed in real-time with trading strategy and its parameters being perpetually and automatically updated, and consequently the trading being performed with self-optimized parameters. The system further includes a module for storing specific order settings and risk / return information. Once execution criteria are satisfied, the order is sent for execution automatically. The system also includes a module for storing information relating to the Buy / Sell transactions and to the profit / loss accounting.

Owner:MAKOR ISSUES & RIGHTS

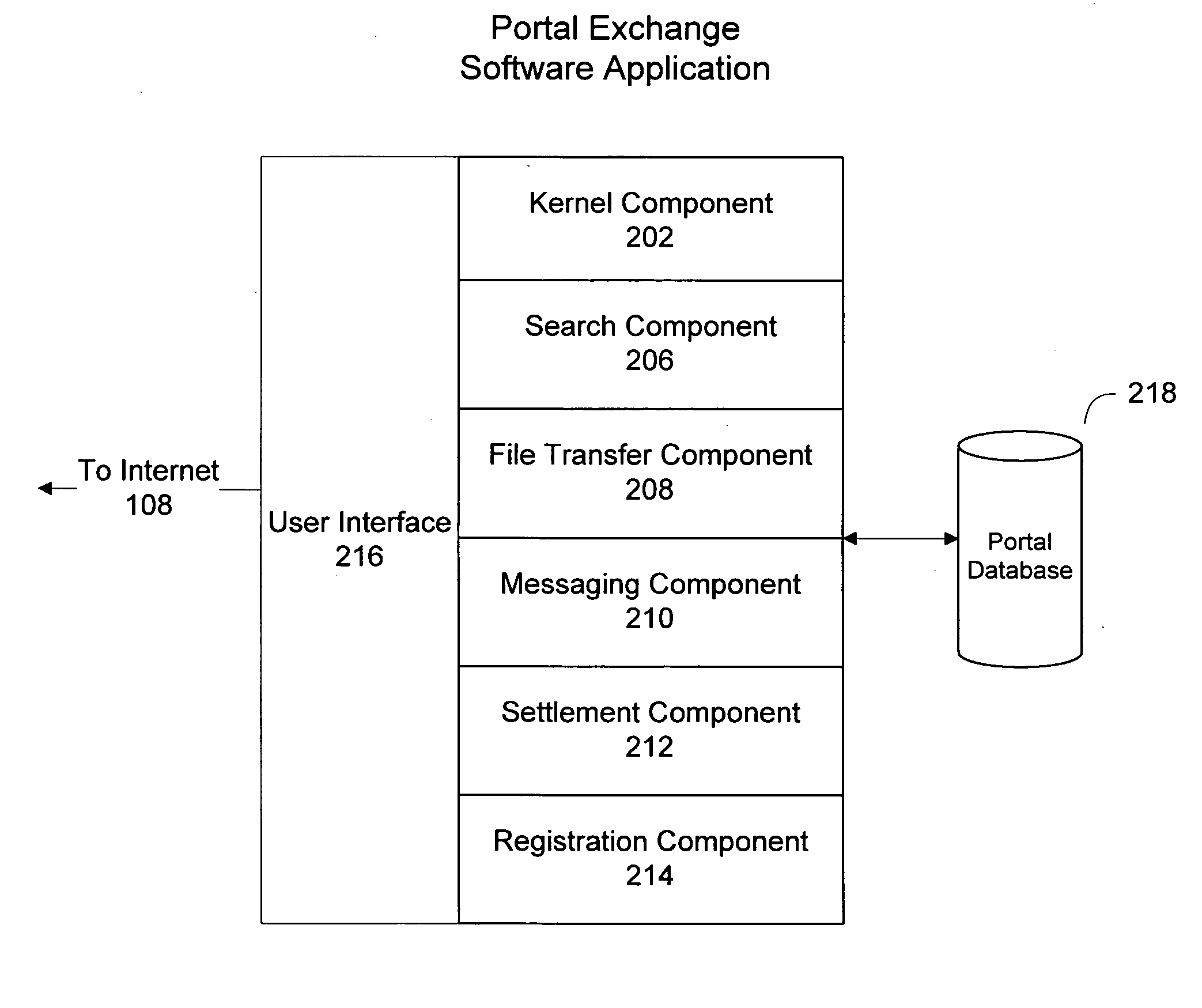

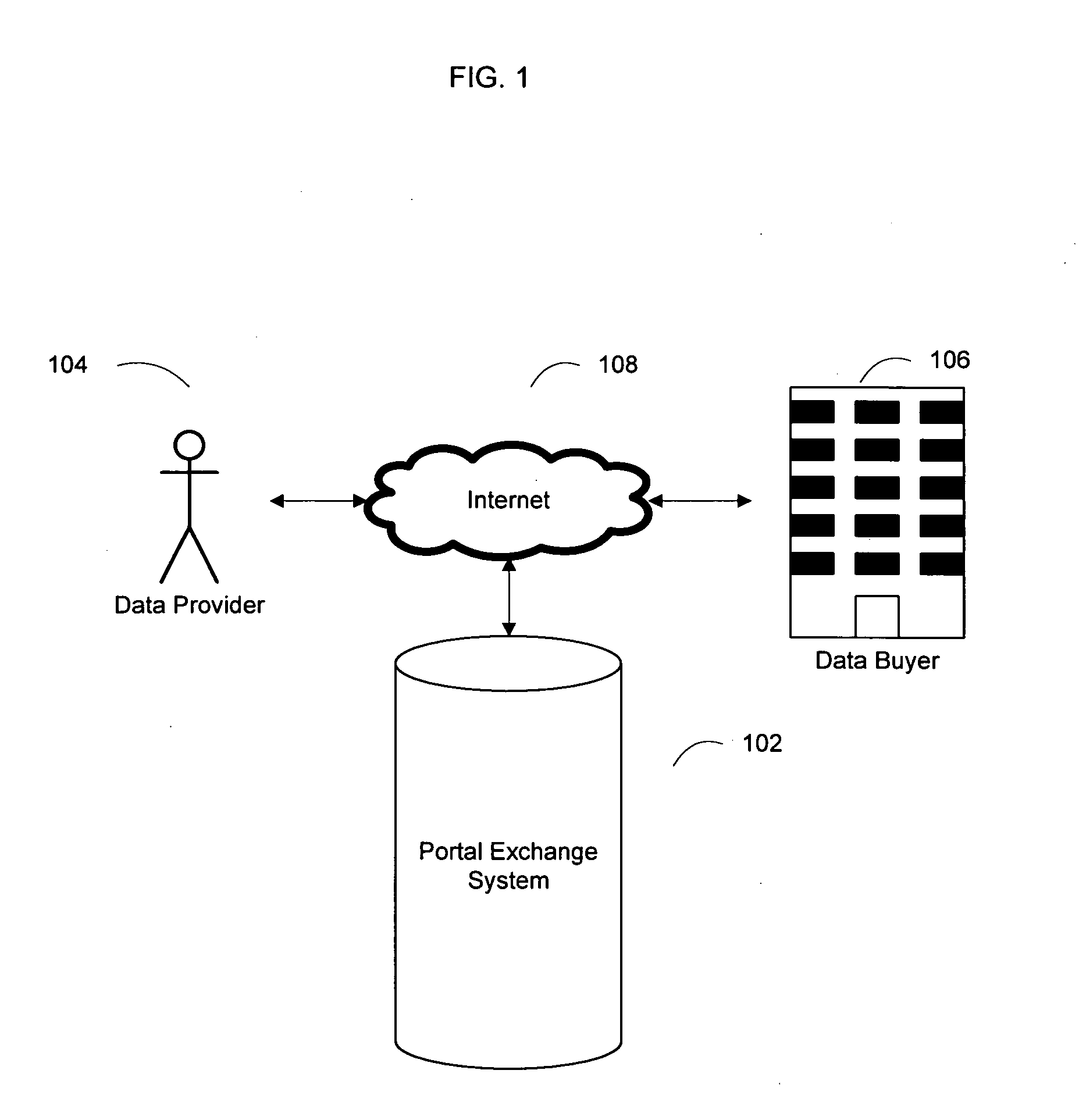

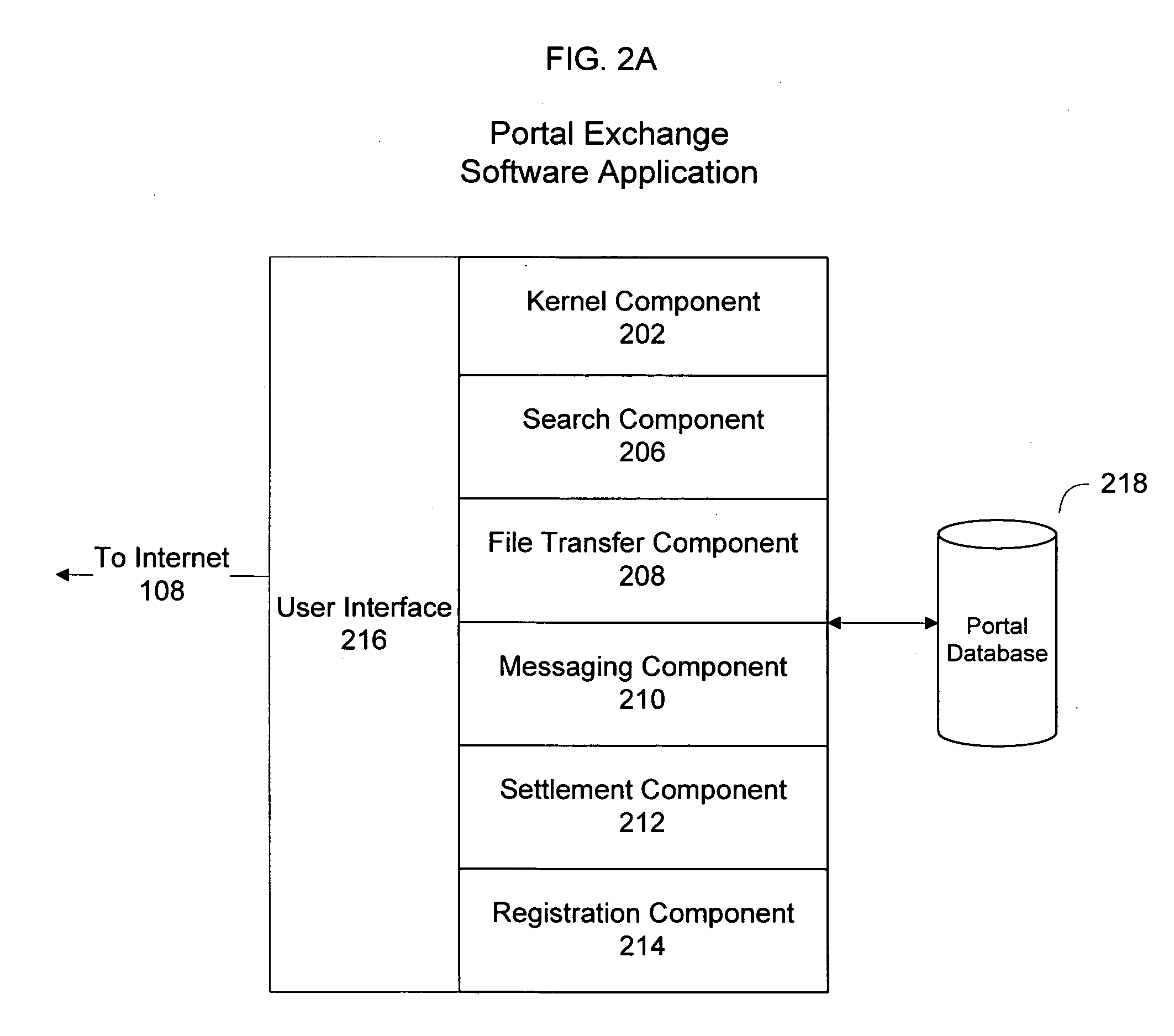

System and method for an online exchange of private data

Based on the small world theory of networking, the present invention provides access to a previously unavailable source of private data, necessary for commerce, by facilitating the sale of private data from members of the general public. For example, the seeker of private data, such as consumer information, submits a data request to an online portal system. The request submission includes legal representations stating the legally permissible purpose for seeking the information. The portal system may display the data request to registered data providers, based on their demographic data. The system facilitates the exchange between the data buyer and the data provider. A payment invoice can be generated and electronically presented by the portal system. The payment may be electronically debited from the designated account of a data. In addition, a portion of such funds may be retained by the portal entity.

Owner:CREDIGY TECH

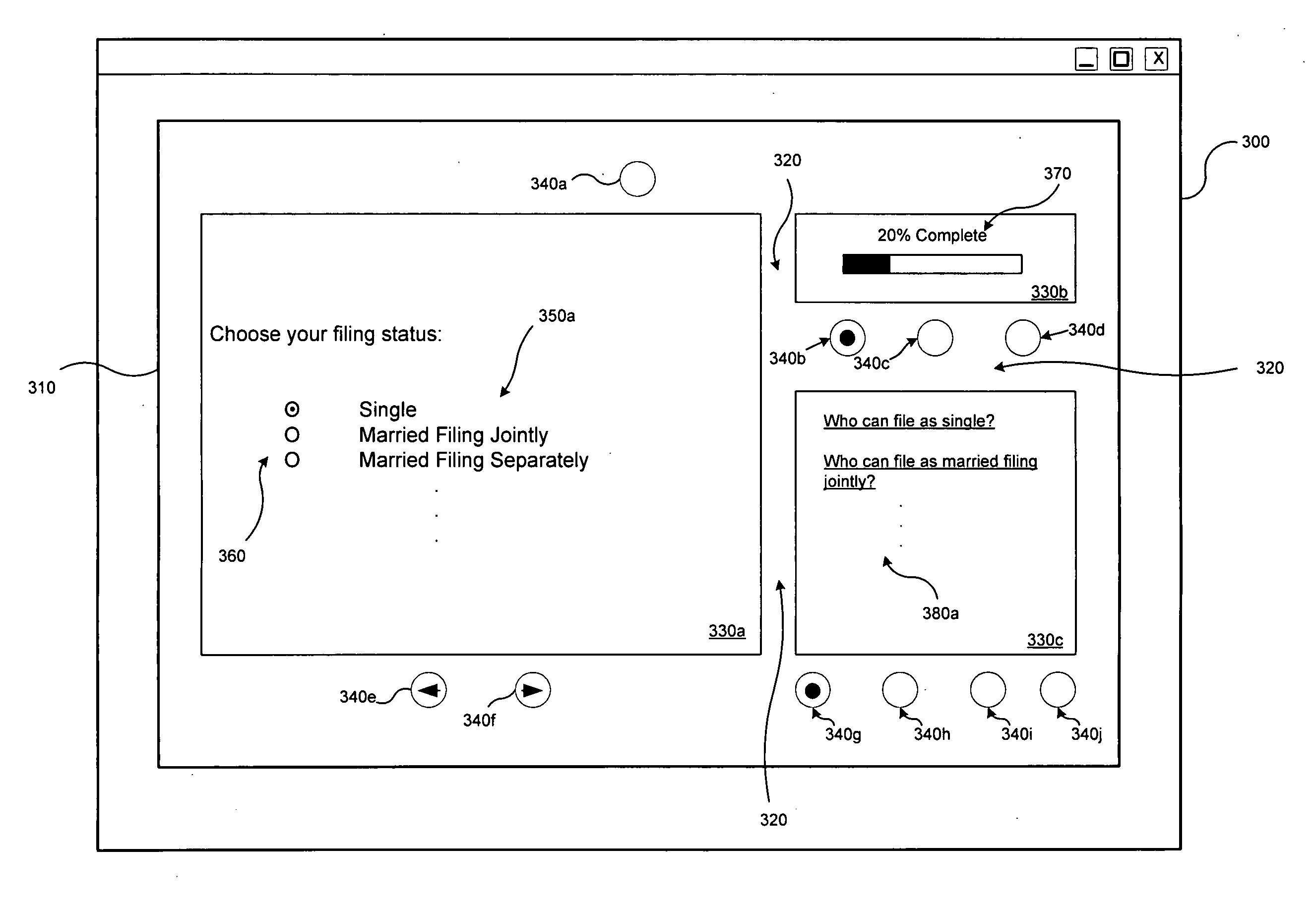

User interface for tax-return preparation

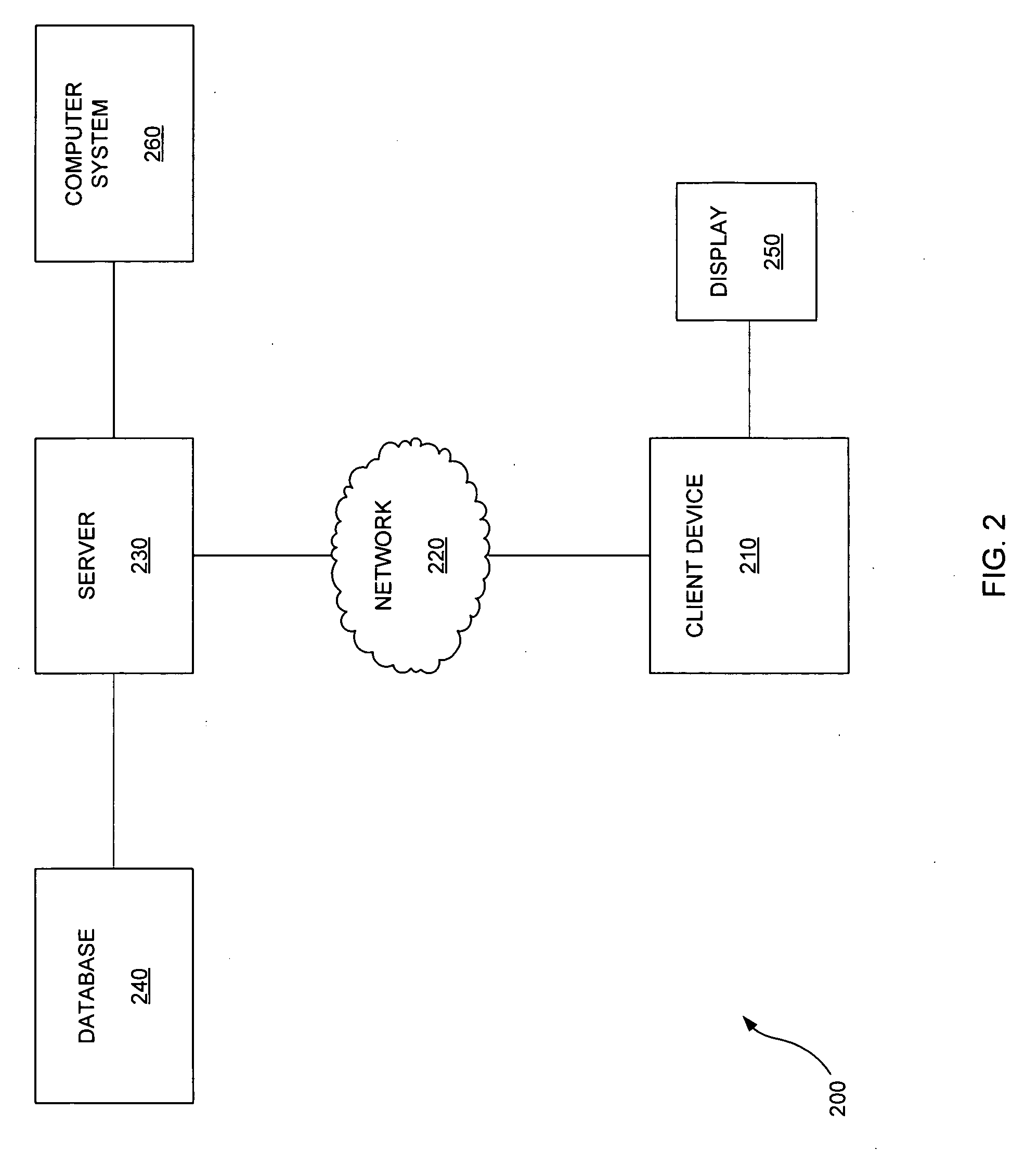

A method is implementable in an electronic system coupled to an electronic device, which is, in turn, coupled to a display device. A web page displayable on the display device is served to the electronic device. The displayed web page includes a user interface, which, in turn, includes a frame and at least one stile defining a plurality of panes within the frame. In a first one of the panes, at least one field into which a tax-data provider can input tax data is displayed. In a second one of the panes, information of a first type of a plurality of information types operable to assist the provider in performing a first operation of a set of operations using the user interface is displayed. Input tax data is received from the electronic device.

Owner:TAXNET

Personal communication and positioning system

InactiveUS6924748B2Reduce and eliminate needInstruments for road network navigationArrangements for variable traffic instructionsData providerDisplay device

A location tagged data provision and display system. A personal communication device (PCD) with electromagnetic communication capability has a GPS receiver and a display. The PCD requests maps and location tagged data from data providers and other for display on the PCD. The data providers respond to requests by using searching and sorting schemes to interrogate data bases and then automatically transmitting data responsive to the requests to the requesting PCD.

Owner:SILVER STATE INTELLECTUAL TECH

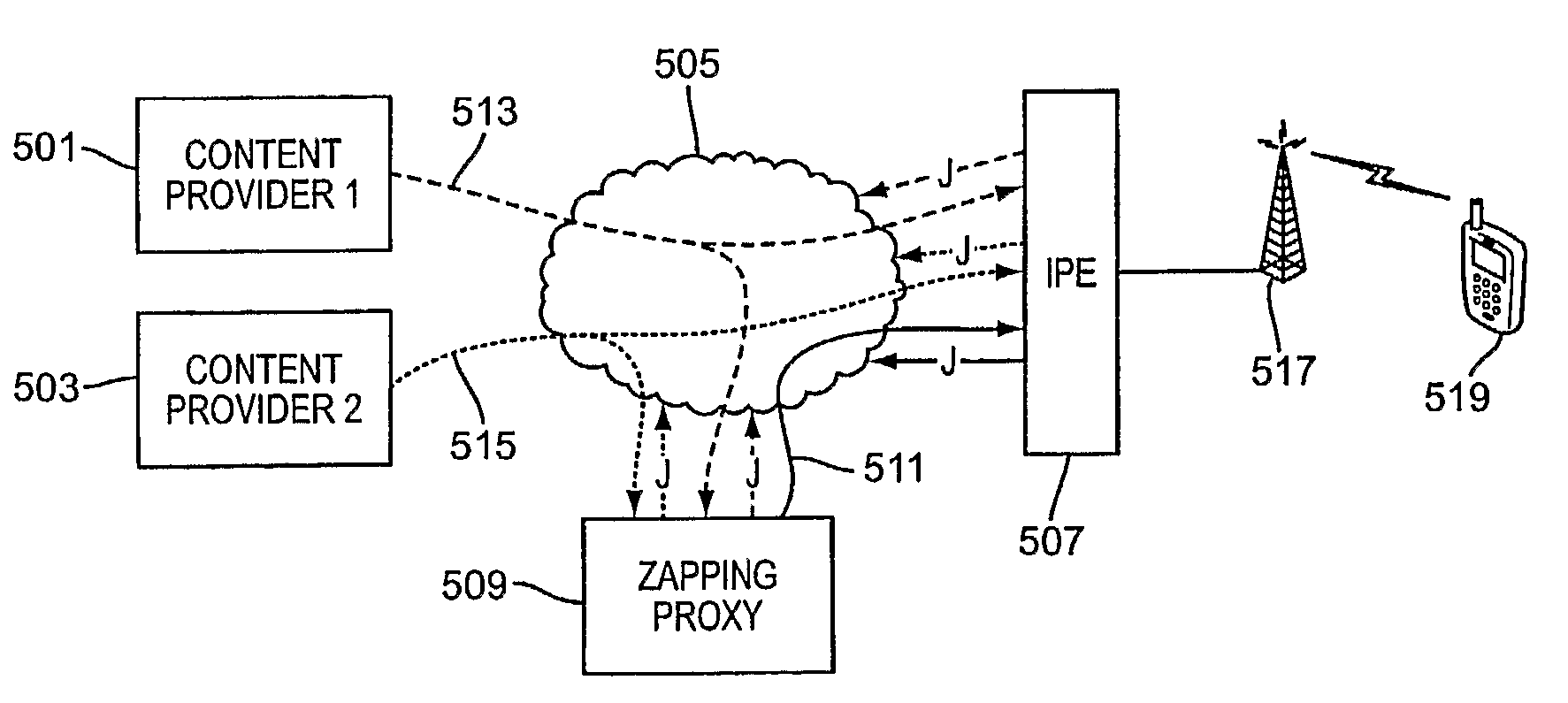

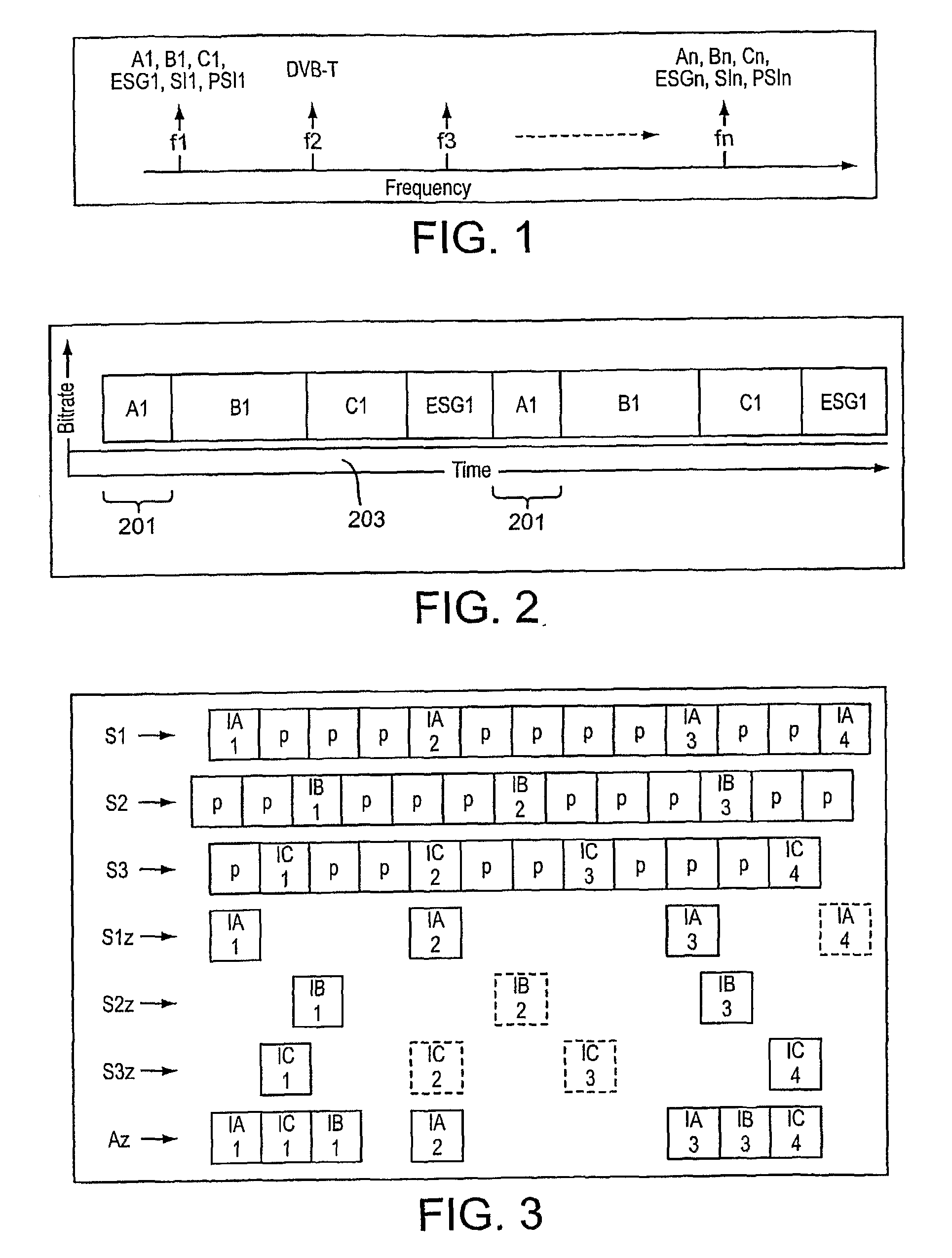

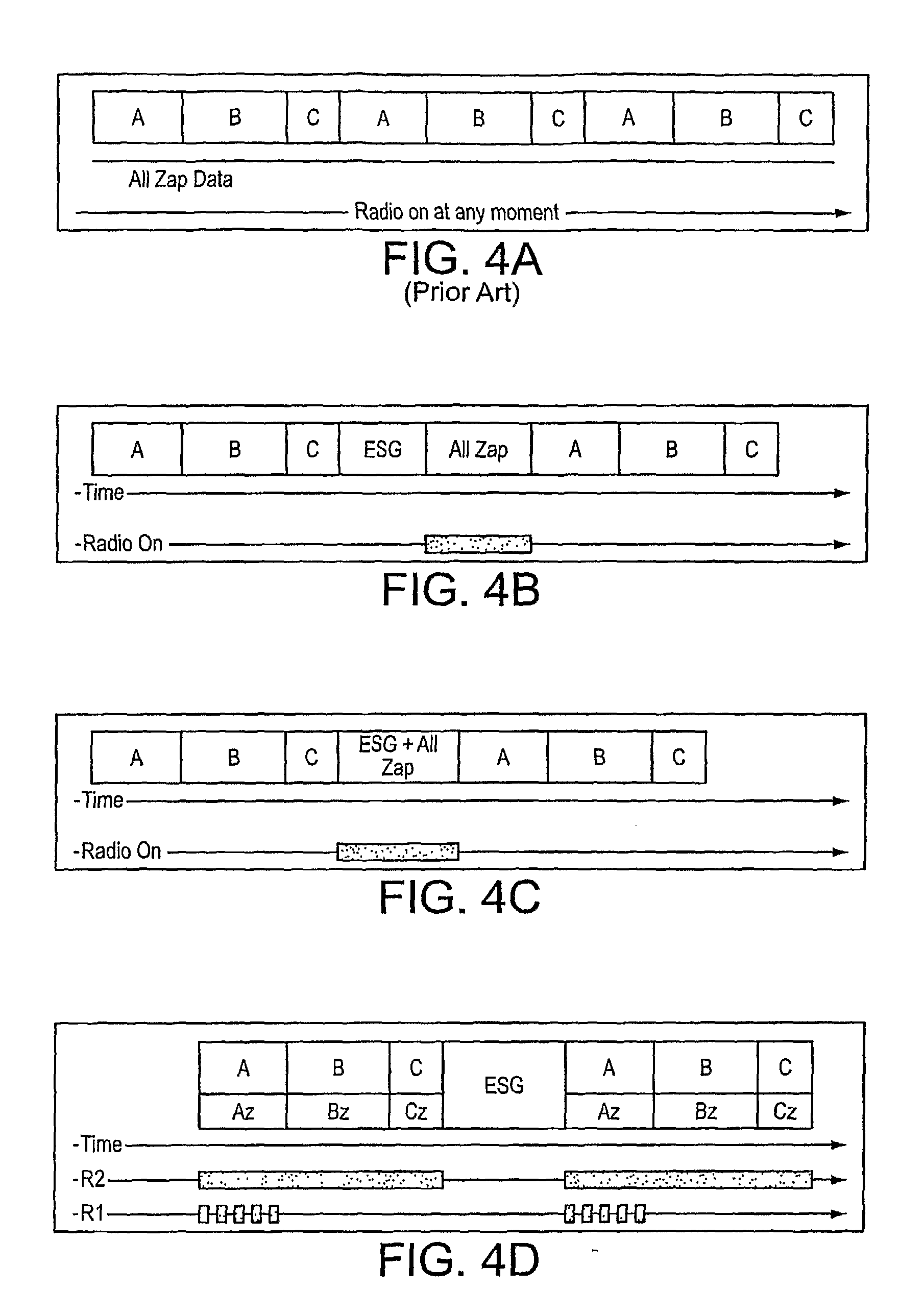

Providing Zapping Streams to Broadcast Receivers

Methods and systems for providing zapping data for one or more programs transmitted using timeslicing are disclosed herein. Zapping data may be provided by a zapping data provider or server, or may be created at the mobile terminal based on received program information. Zapping data may be provided to mobile terminals via a wireless multicast network, such as a DVB-H network, using a variety of timeslicing techniques, including providing a separate zapping data stream, providing zapping data as part of the source stream, or allowing mobile terminals to derive zapping data from the source content's broadcast stream. Zapping images may be selected from I-frames of video transmissions. An IP encapsulator may synchronize broadcast streams such that I-frames are transmitted concurrently, and at the beginning of timeslice bursts.

Owner:NOKIA TECHNOLOGLES OY

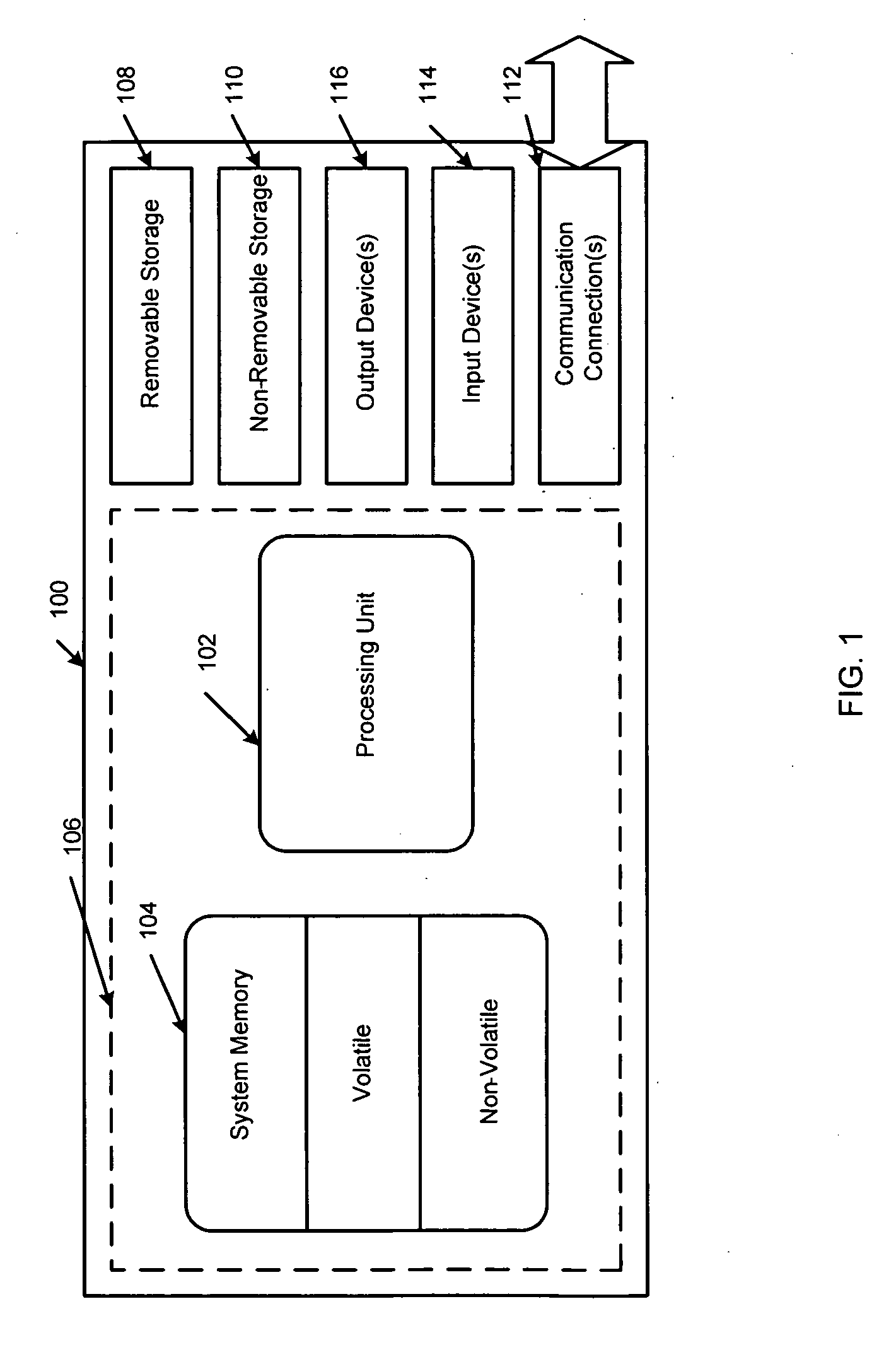

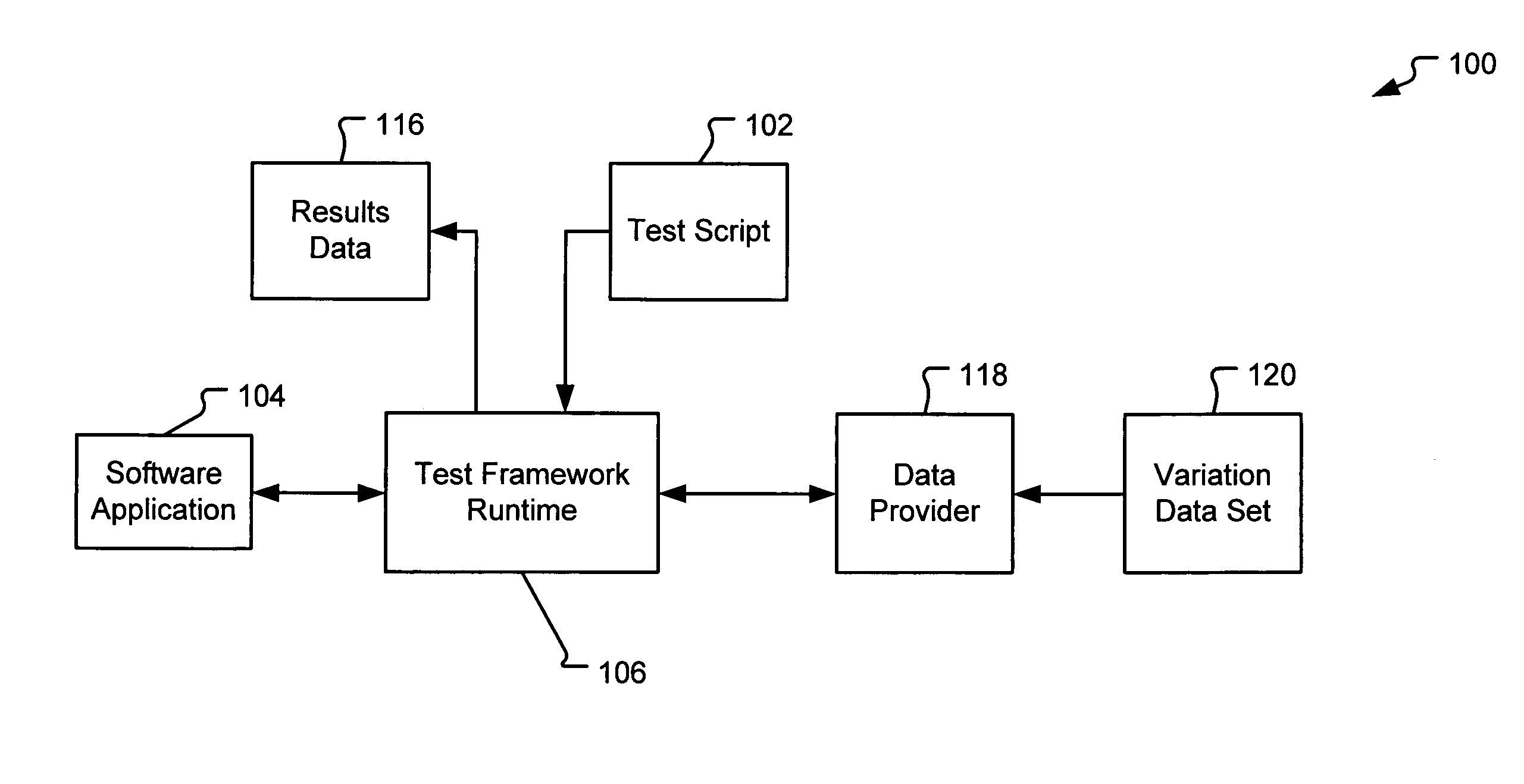

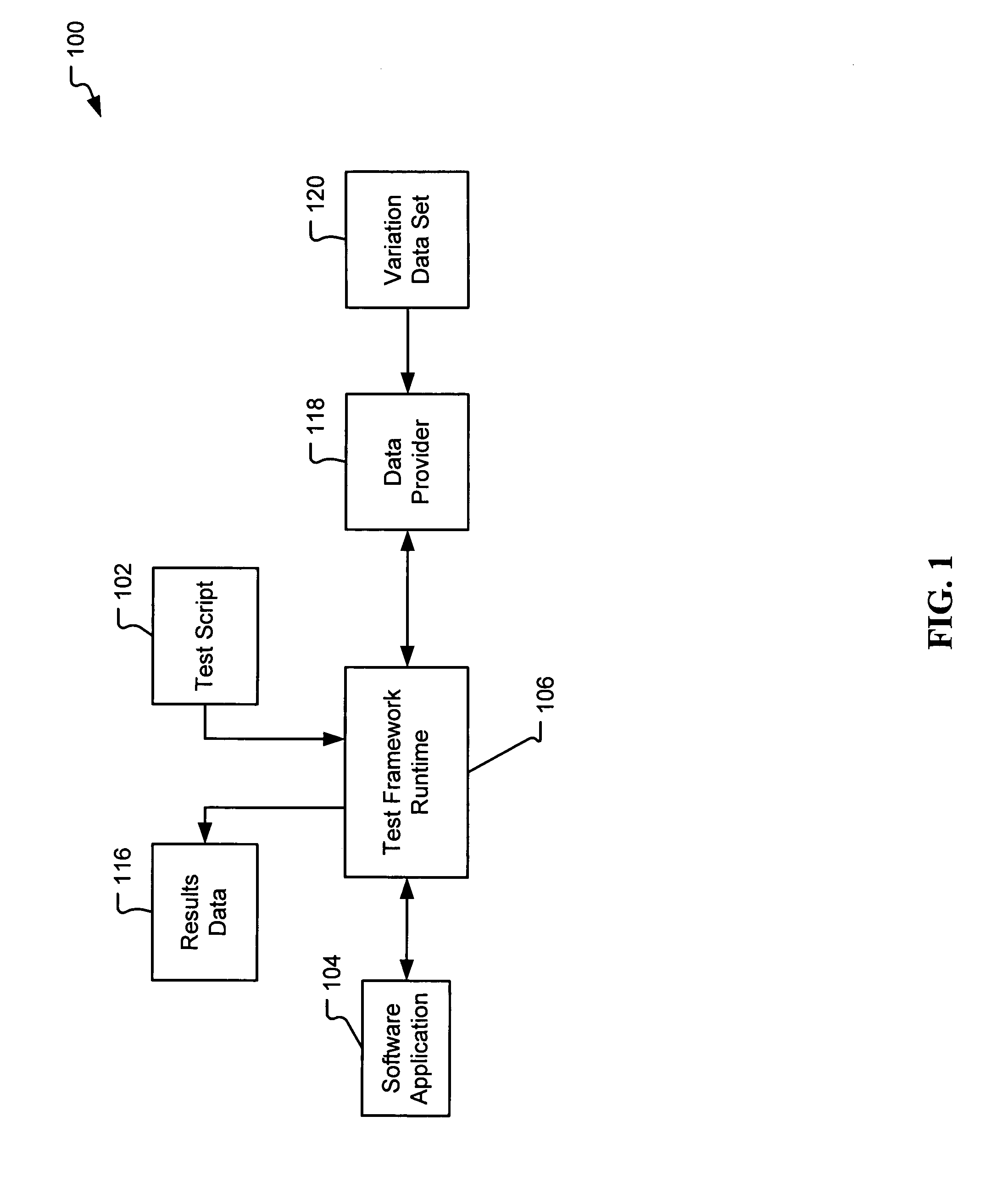

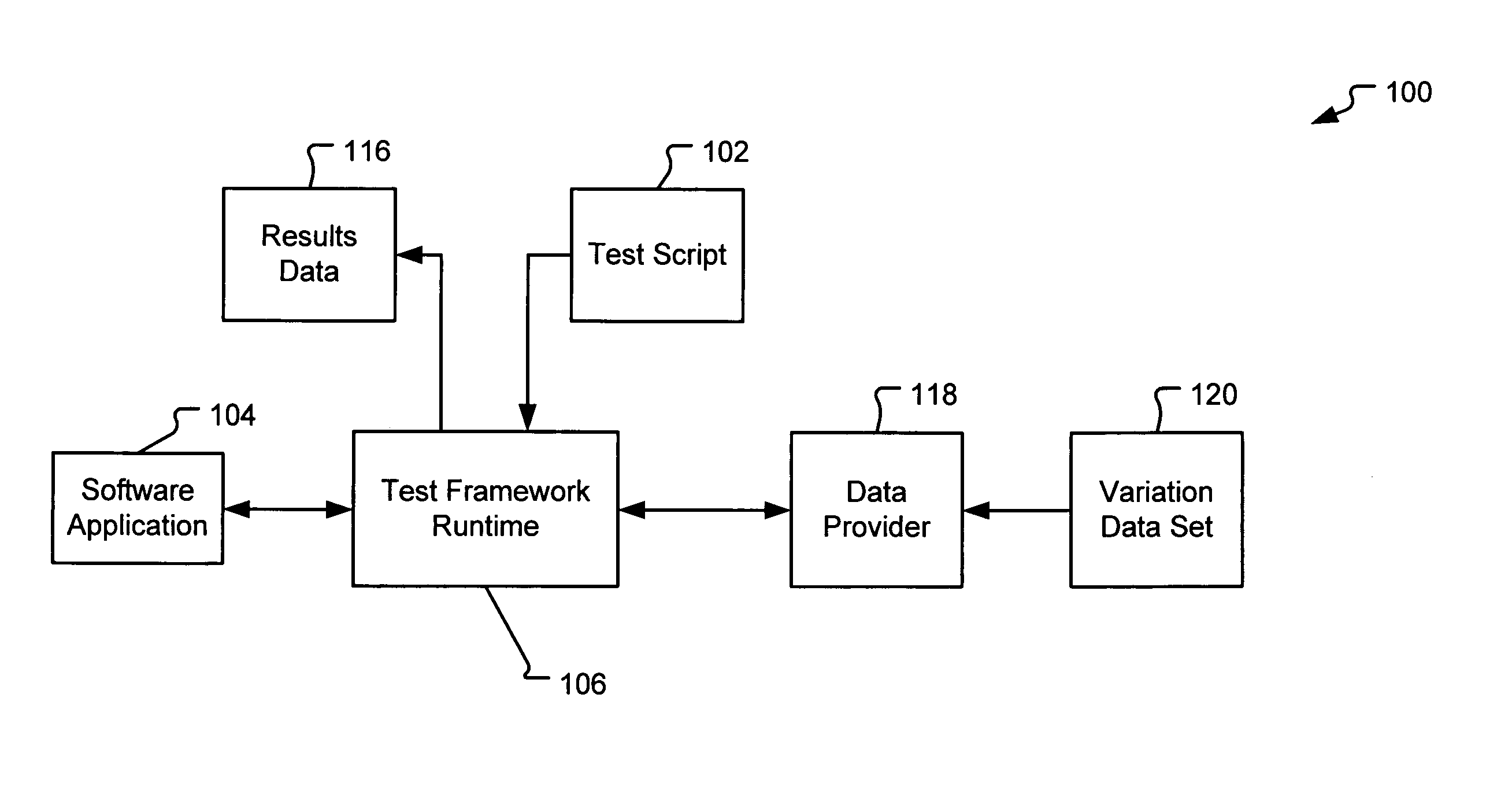

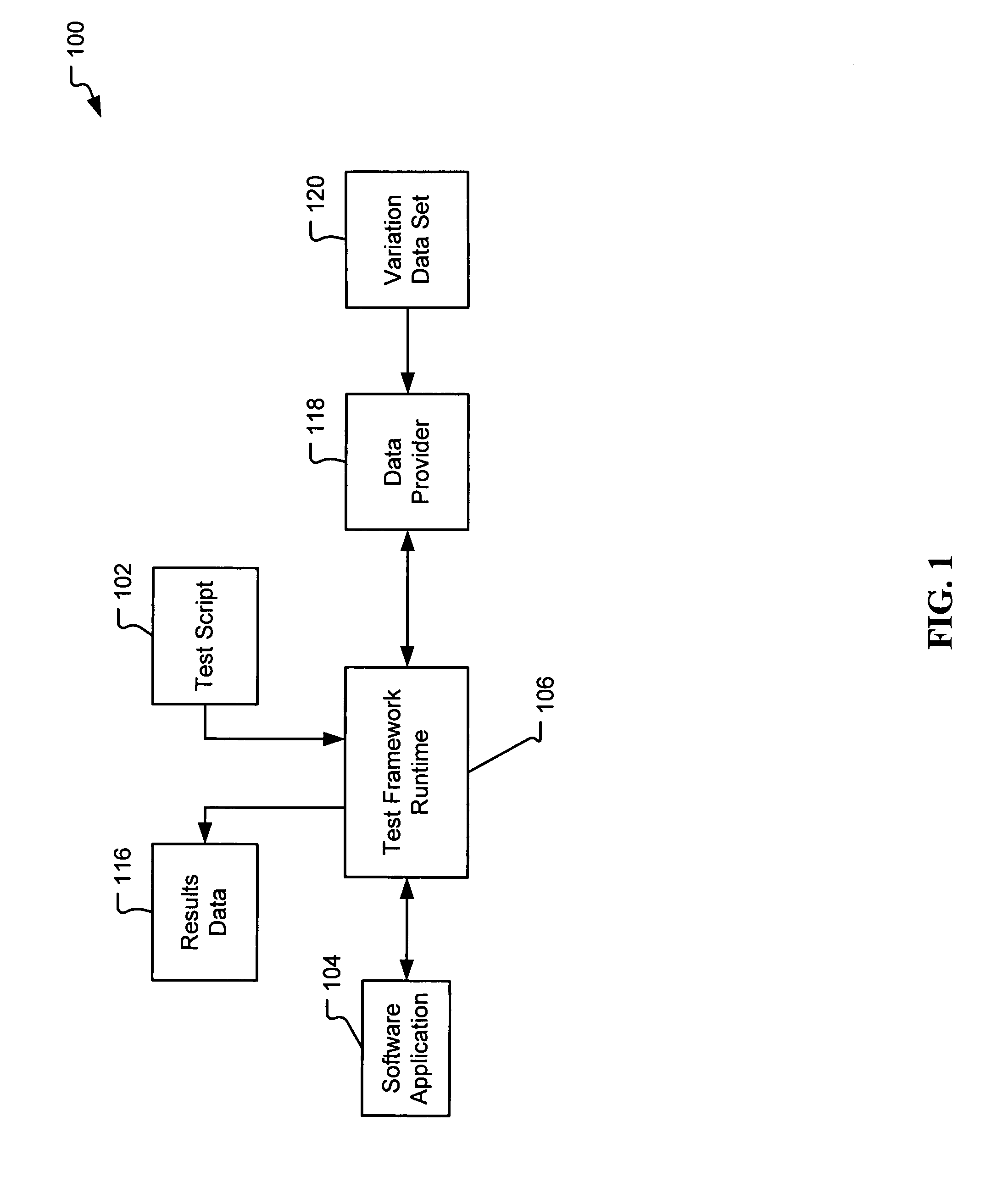

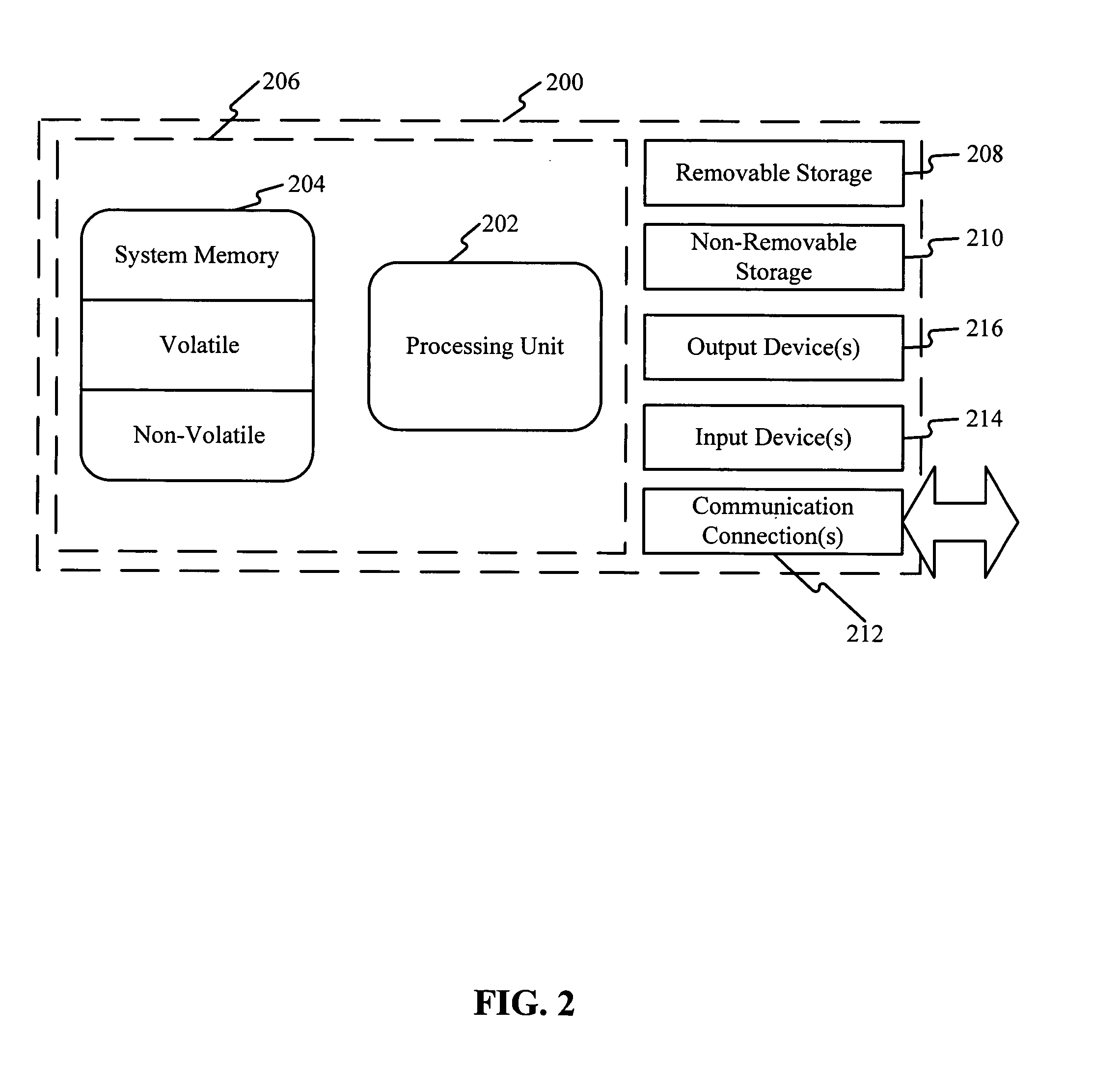

System and method for testing software using data-driven test variations

The integrated test framework of the present invention includes a test framework runtime that executes test scripts and that also allows a script to identify a variation tool called a “data provider” that is responsible for providing data to the test framework runtime and controlling the iteration of the runtime through the variations. The script also identifies the type of data set from which the data provider should obtain the data from which the variations are derived and the location of the data set. Multiple variation data providers may be used in conjunction with an adapter layer that coordinates the iteration of each variation data provider and creates an aggregated variation over multiple varying parameters of different scope.

Owner:MICROSOFT TECH LICENSING LLC

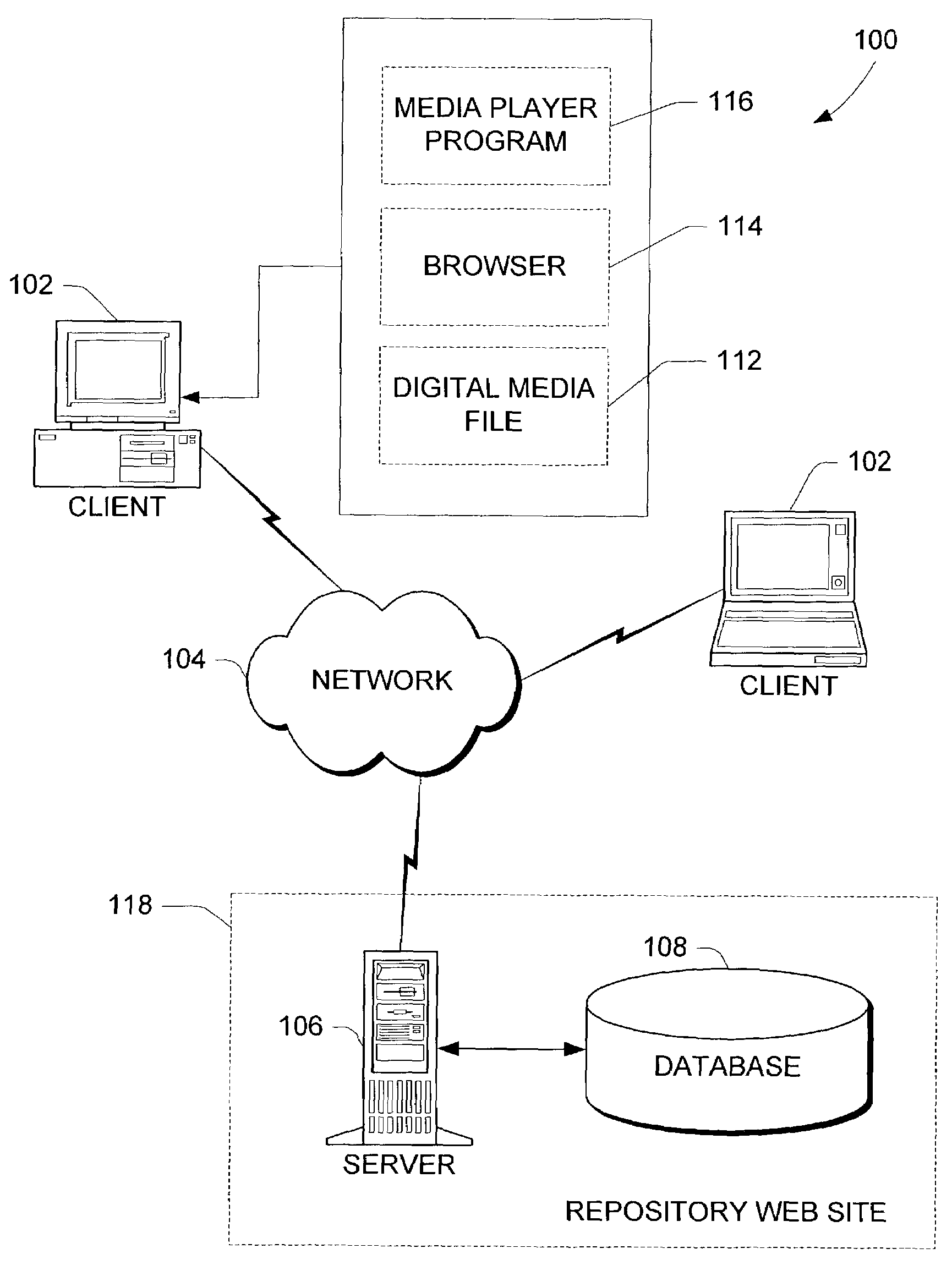

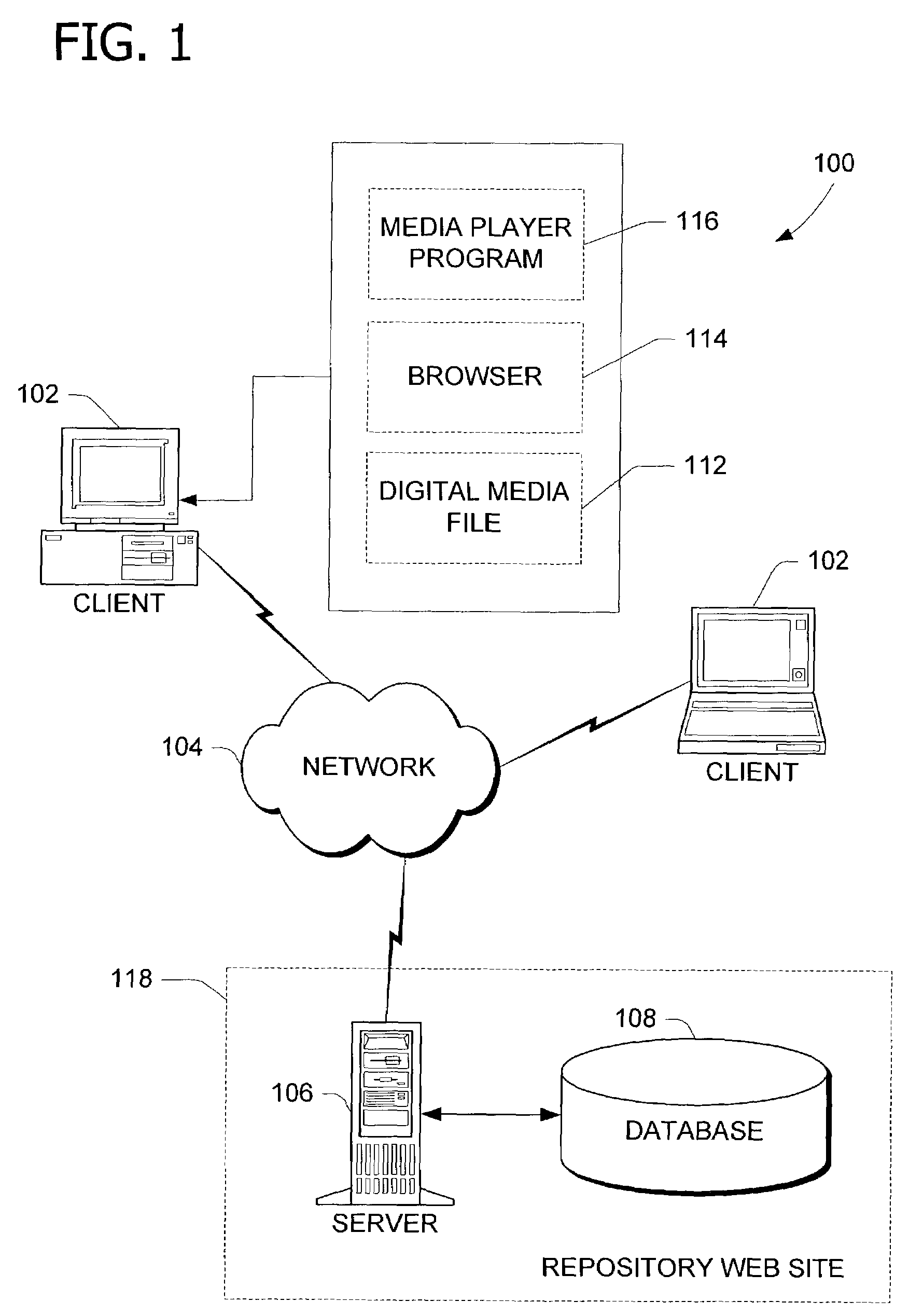

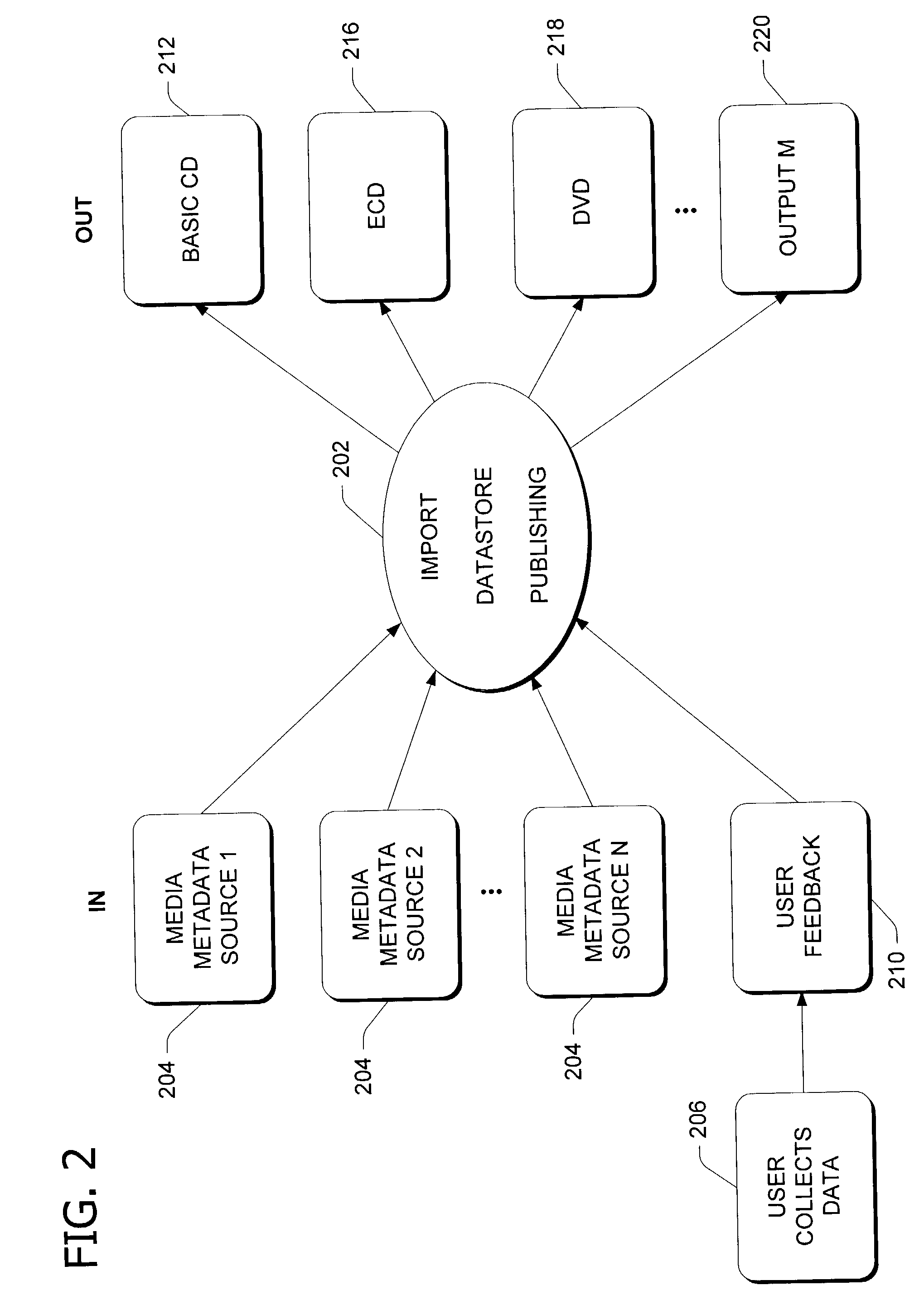

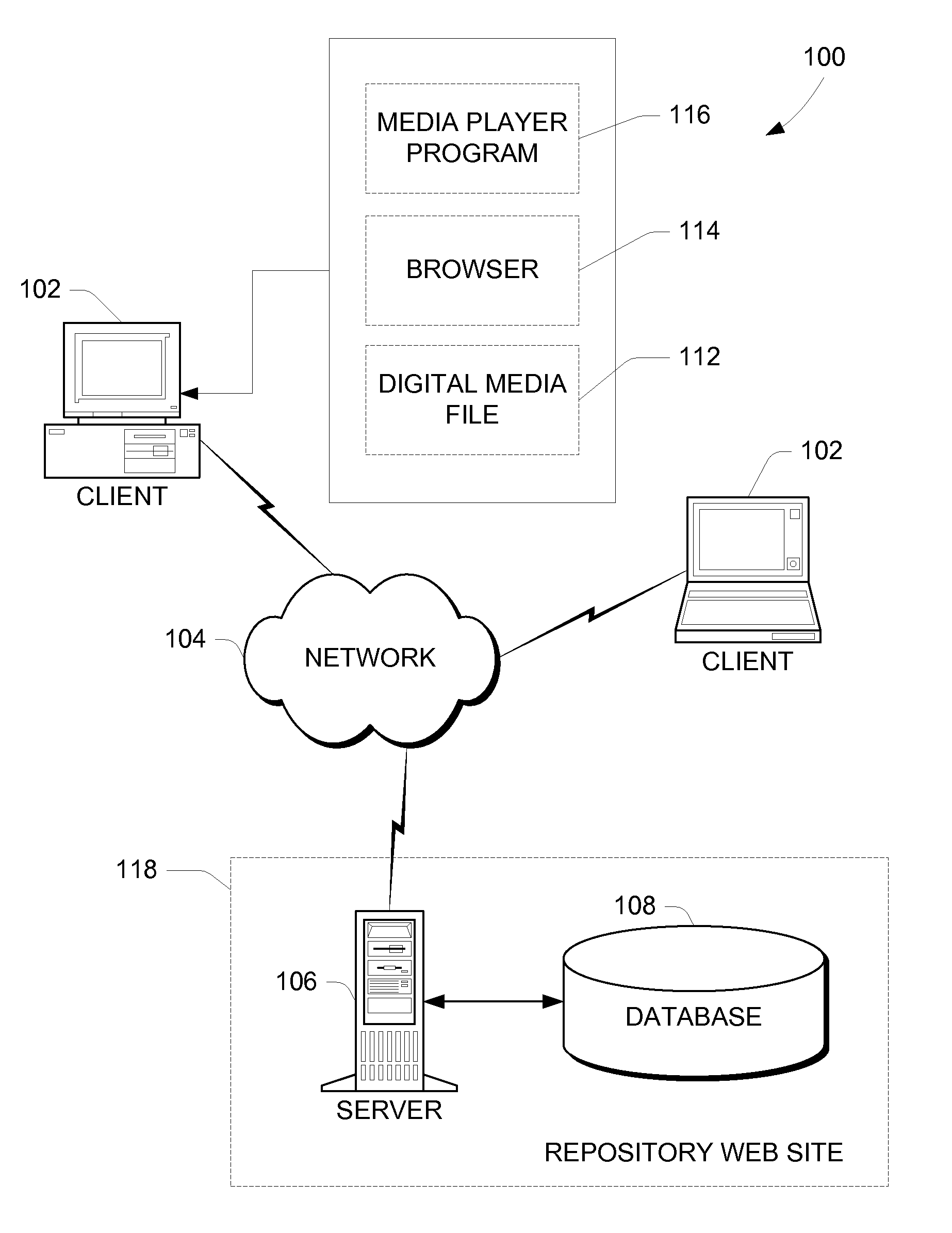

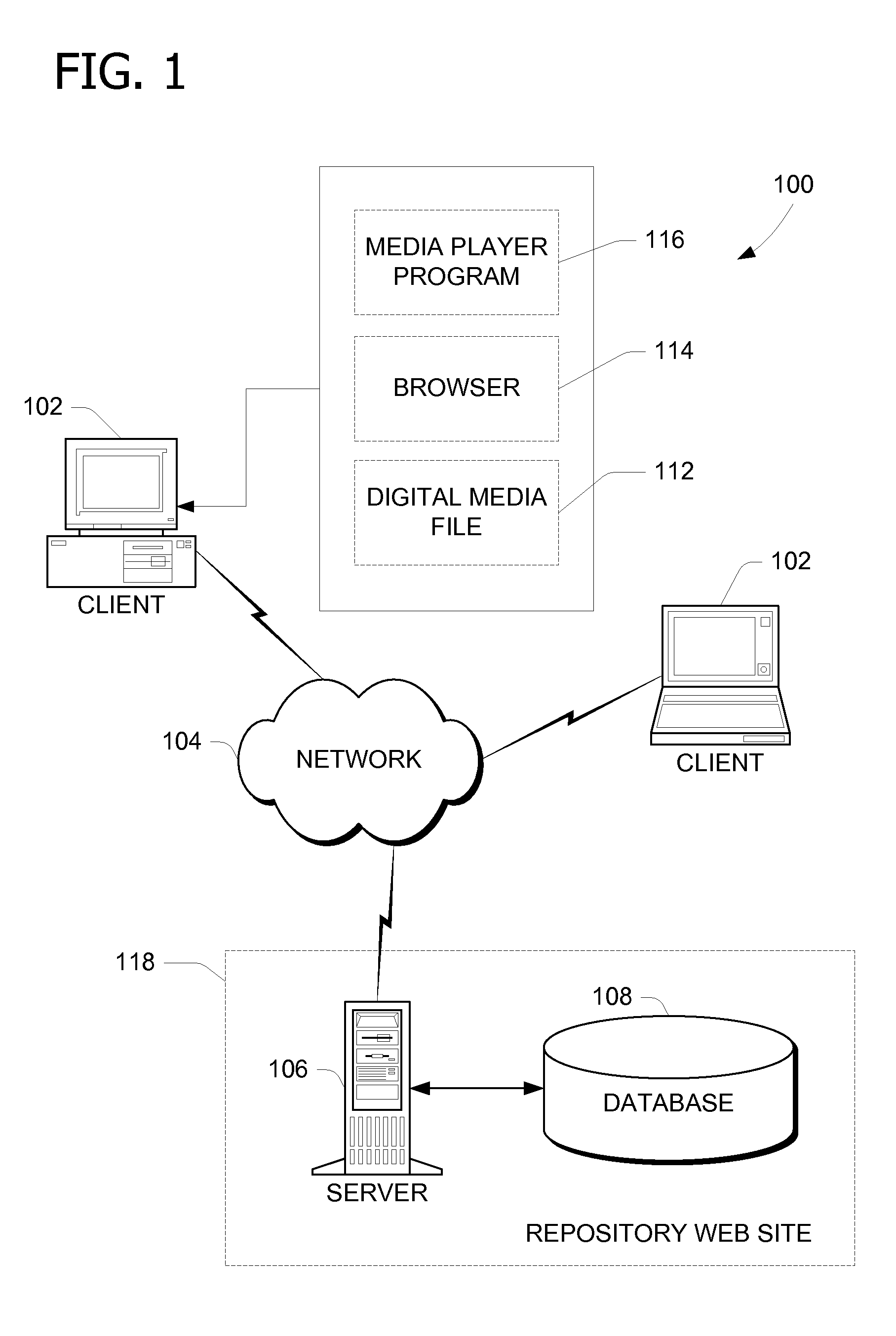

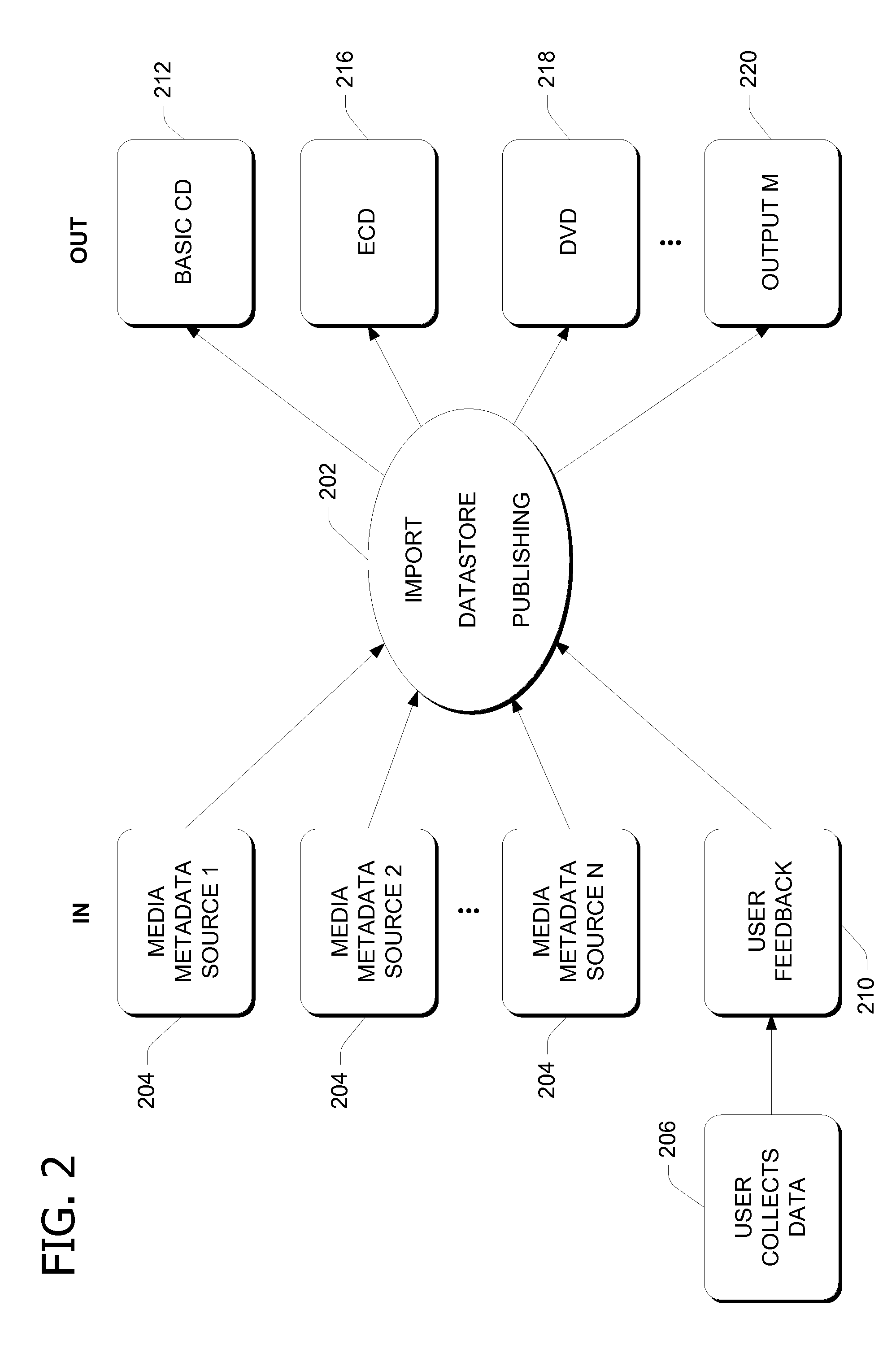

Media identifier registry

InactiveUS7136866B2Improve user experienceLess laborData processing applicationsMetadata multimedia retrievalRelevant informationData warehouse

A media identifier registry for managing metadata records. The registry stores a unique logical identifier for each of the records as well as a base type corresponding to each of the logical identifiers. The base types are representative of the information contained in the respective metadata records for the corresponding logical identifiers. The registry further defines associations between the logical identifiers and base types. Improvements in identifying media content and related information according to the invention permit building a media data warehouse capable of aggregating data from many different sources, uniquely identify the same piece of content from different data providers, in different cultures, and in different physical forms to allow a consistent set of data to be stored and retrieved.

Owner:MICROSOFT TECH LICENSING LLC

System and method for testing software using data-driven test variations

The integrated test framework of the present invention includes a test framework runtime that executes test scripts and that also allows a script to identify a variation tool called a “data provider” that is responsible for providing data to the test framework runtime and controlling the iteration of the runtime through the variations. The script also identifies the type of data set from which the data provider should obtain the data from which the variations are derived and the location of the data set. Multiple variation data providers may be used in conjunction with an adapter layer that coordinates the iteration of each variation data provider and creates an aggregated variation over multiple varying parameters of different scope.

Owner:MICROSOFT TECH LICENSING LLC

Media identifier registry

InactiveUS20070073767A1Improve user experienceLess laborData processing applicationsDigital data processing detailsData warehouseRelevant information

A media identifier registry for managing metadata records. The registry stores a unique logical identifier for each of the records as well as a base type corresponding to each of the logical identifiers. The base types are representative of the information contained in the respective metadata records for the corresponding logical identifiers. The registry further defines associations between the logical identifiers and base types. Improvements in identifying media content and related information according to the invention permit building a media data warehouse capable of aggregating data from many different sources, uniquely identify the same piece of content from different data providers, in different cultures, and in different physical forms to allow a consistent set of data to be stored and retrieved.

Owner:MICROSOFT TECH LICENSING LLC

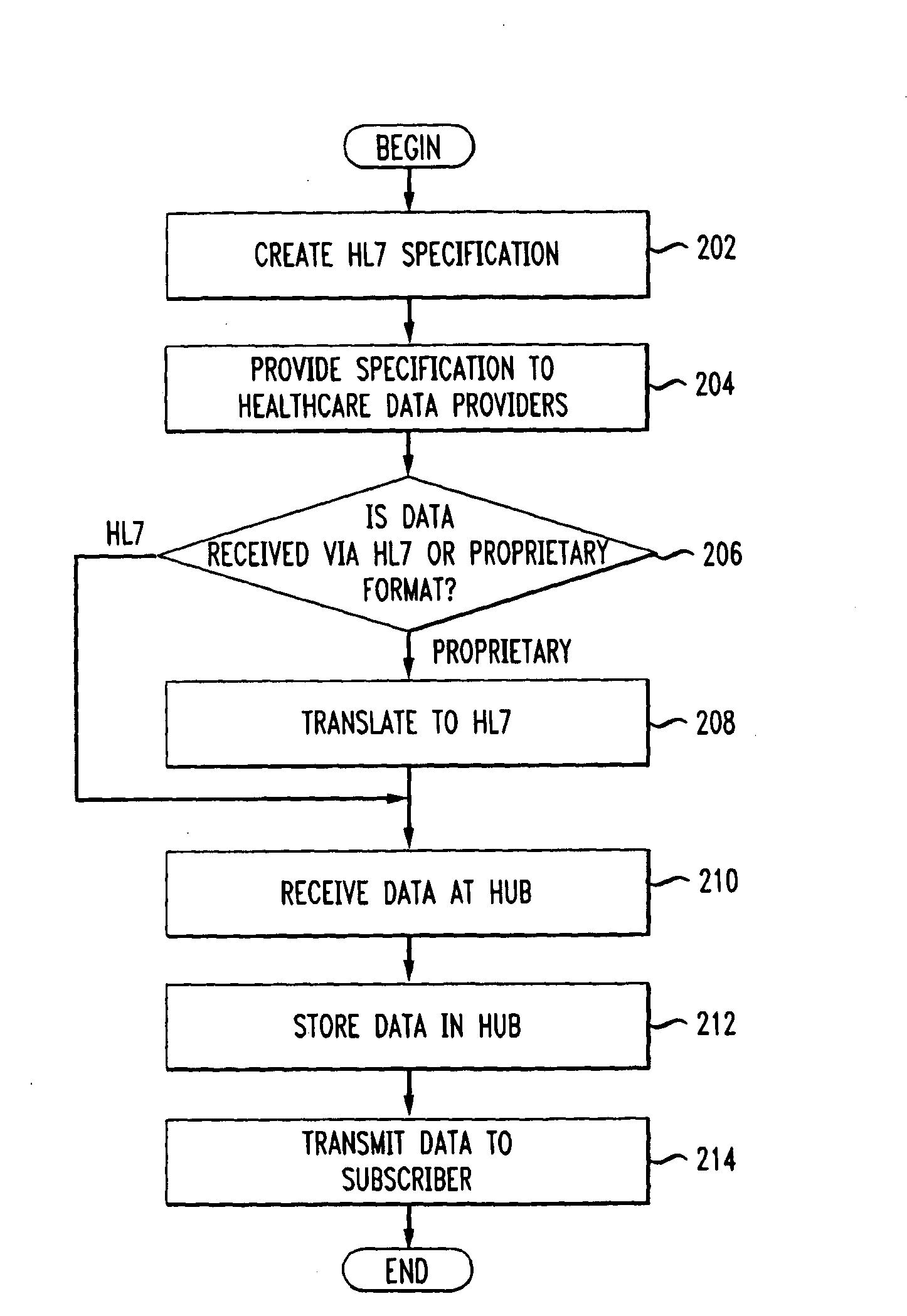

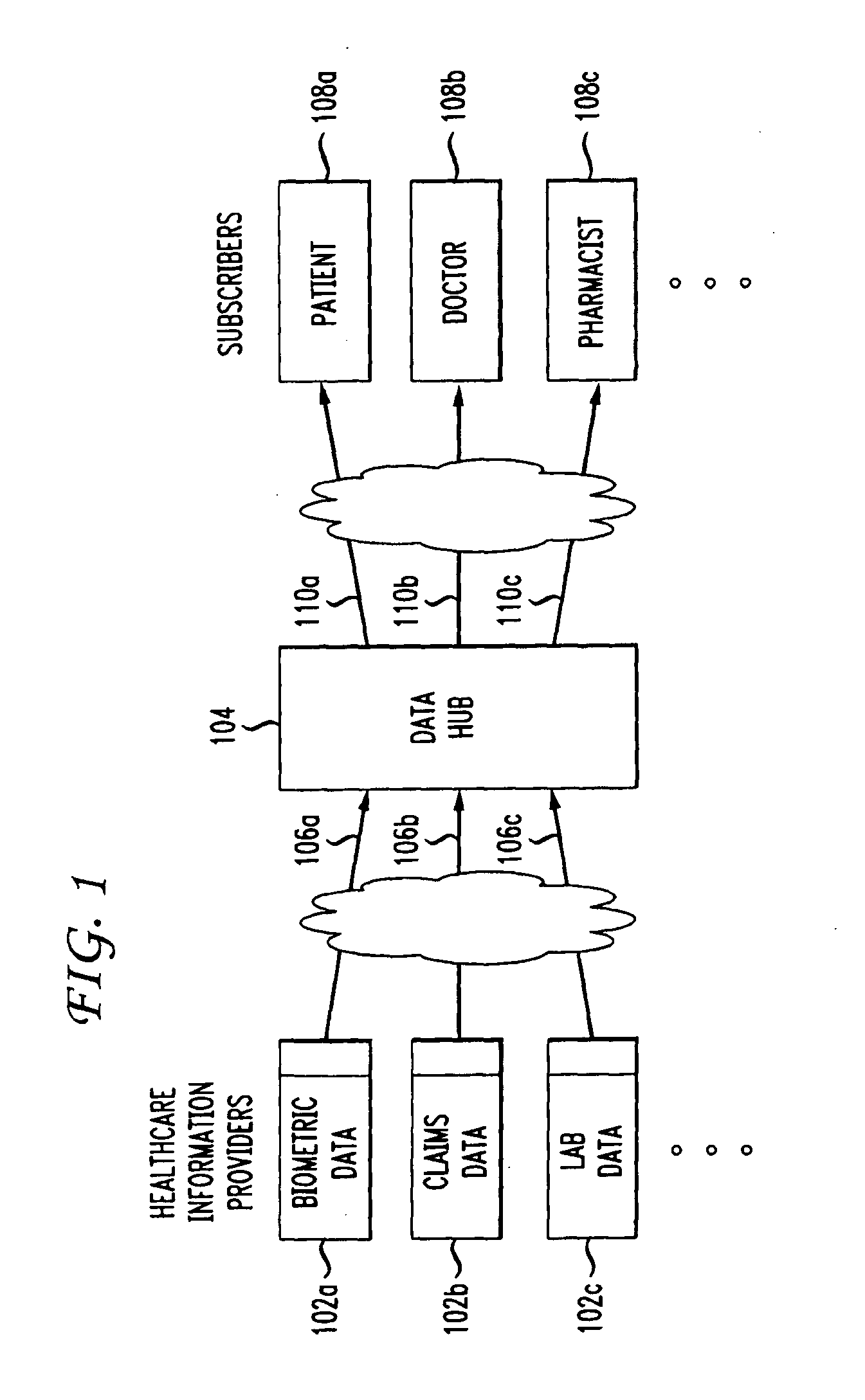

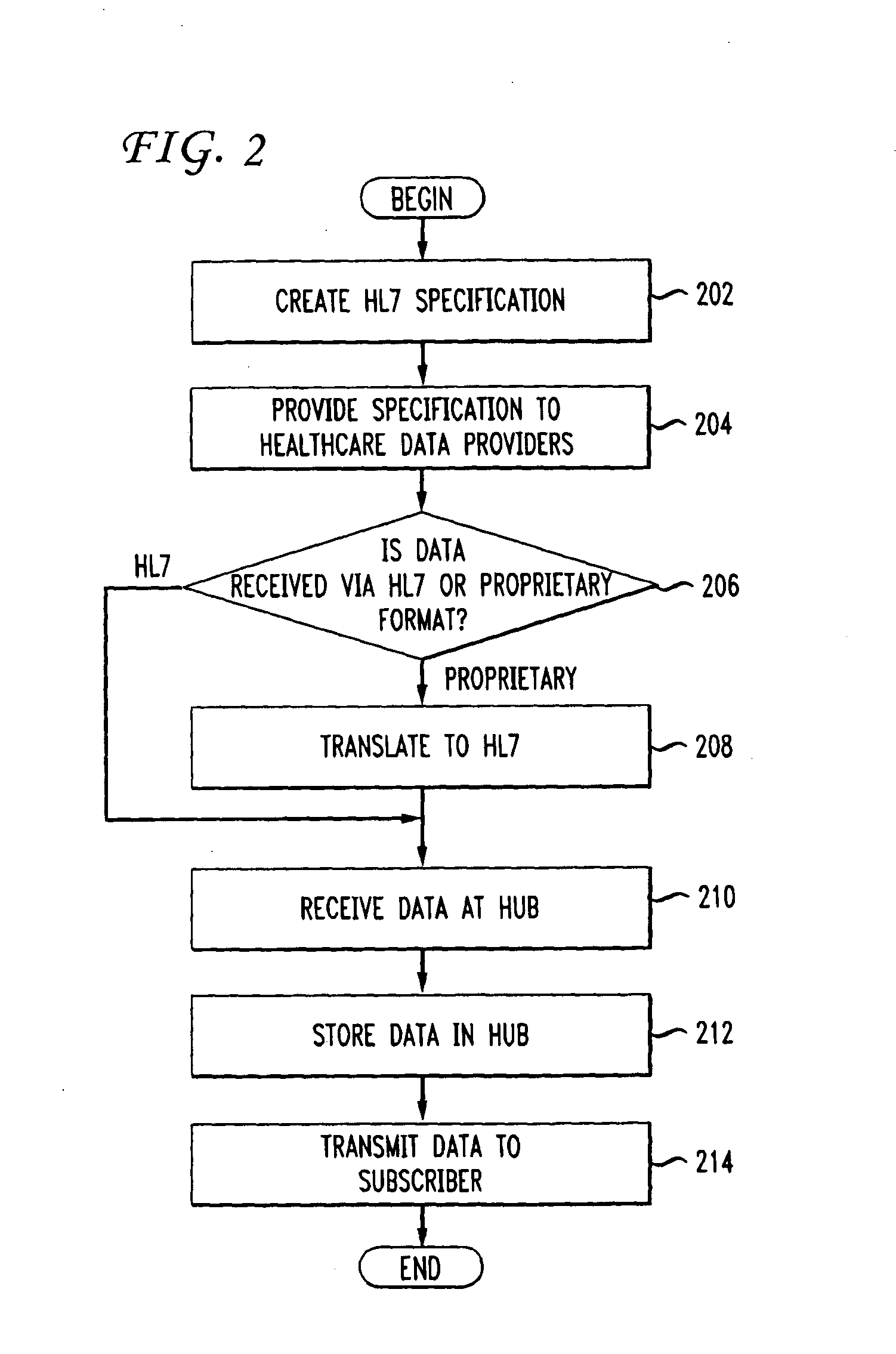

Standardized health data hub

A central health data repository stores health data from various data providers and provides data to various data consumers. The data hub is a standardized central repository that conforms to various standards, such as Health Level Seven (HL7). The data is received according to the HL7 specification and is transmitted to the various data providers using HL7. The data may also be transmitted as a continuous data feed. In this manner, a large volume of health data may be collected, stored, and disseminated using the data hub as a standardized service. A computer system includes one or more processors, an output network interface and an input network interface, a memory for storing multiple personal health records having fields for storing data in a proprietary format or in a standard format. The memory may also include an HL7 translation module and a data insertion / retrieval code module, wherein the computer system performs as a standardized health data repository for various entities in the healthcare industry.

Owner:IMETRIKUS

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com