Patents

Literature

1034 results about "Online payment" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

An e-commerce payment system (or an electronic payment system) facilitates the acceptance of electronic payment for online transactions. Also known as a subcomponent of Electronic Data Interchange (EDI), e-commerce payment systems have become increasingly popular due to the widespread use of the internet-based shopping and banking.

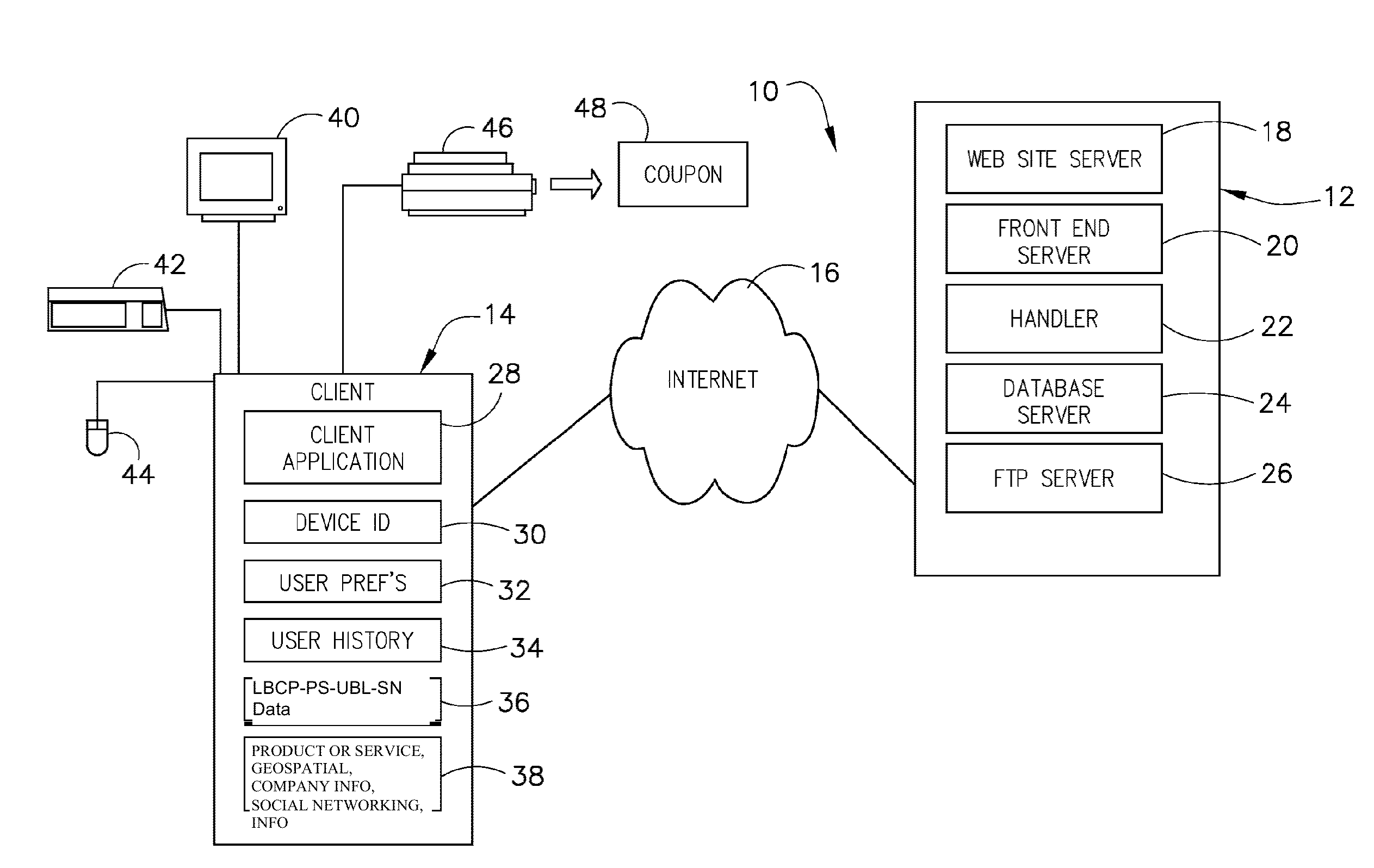

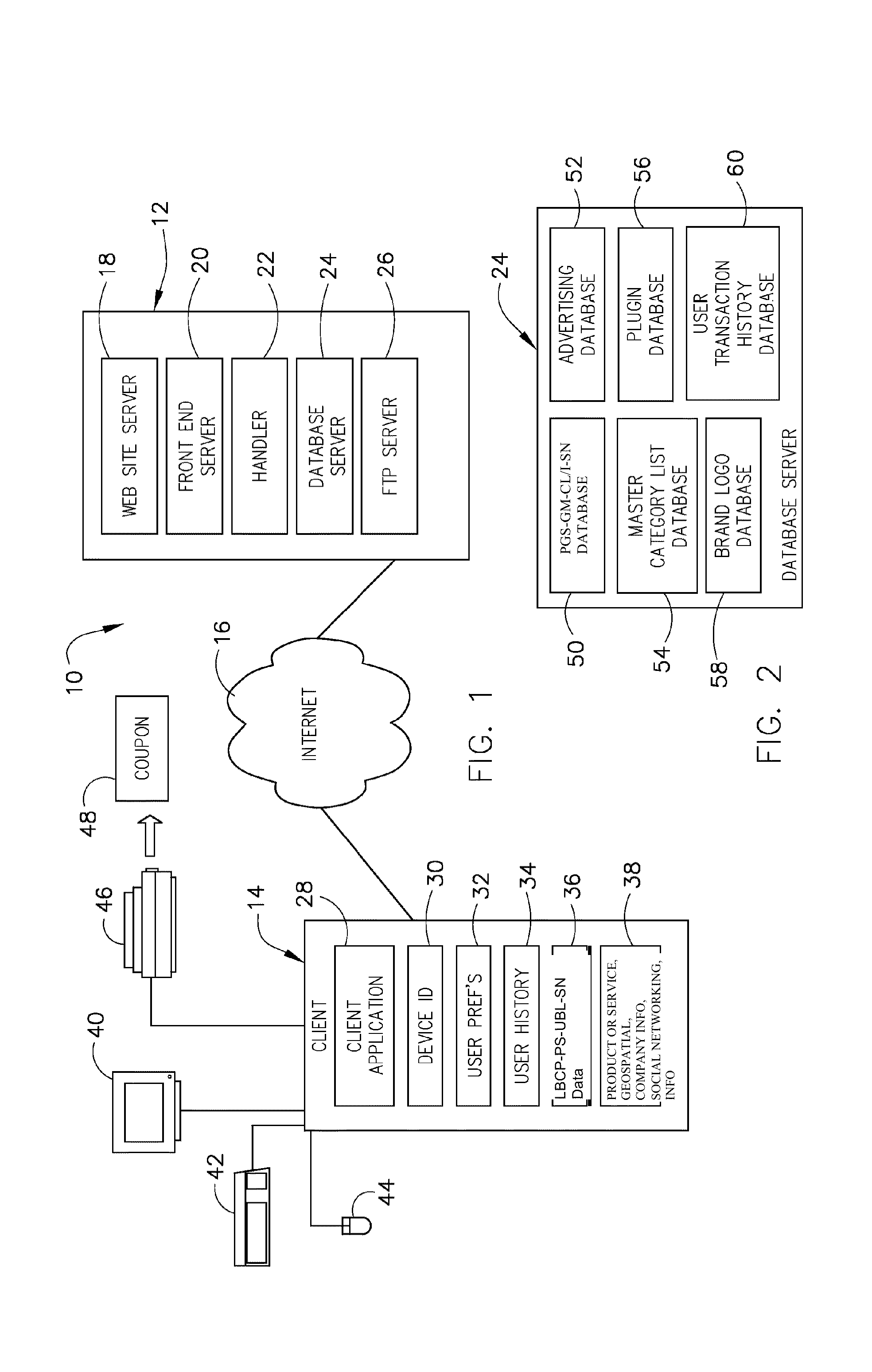

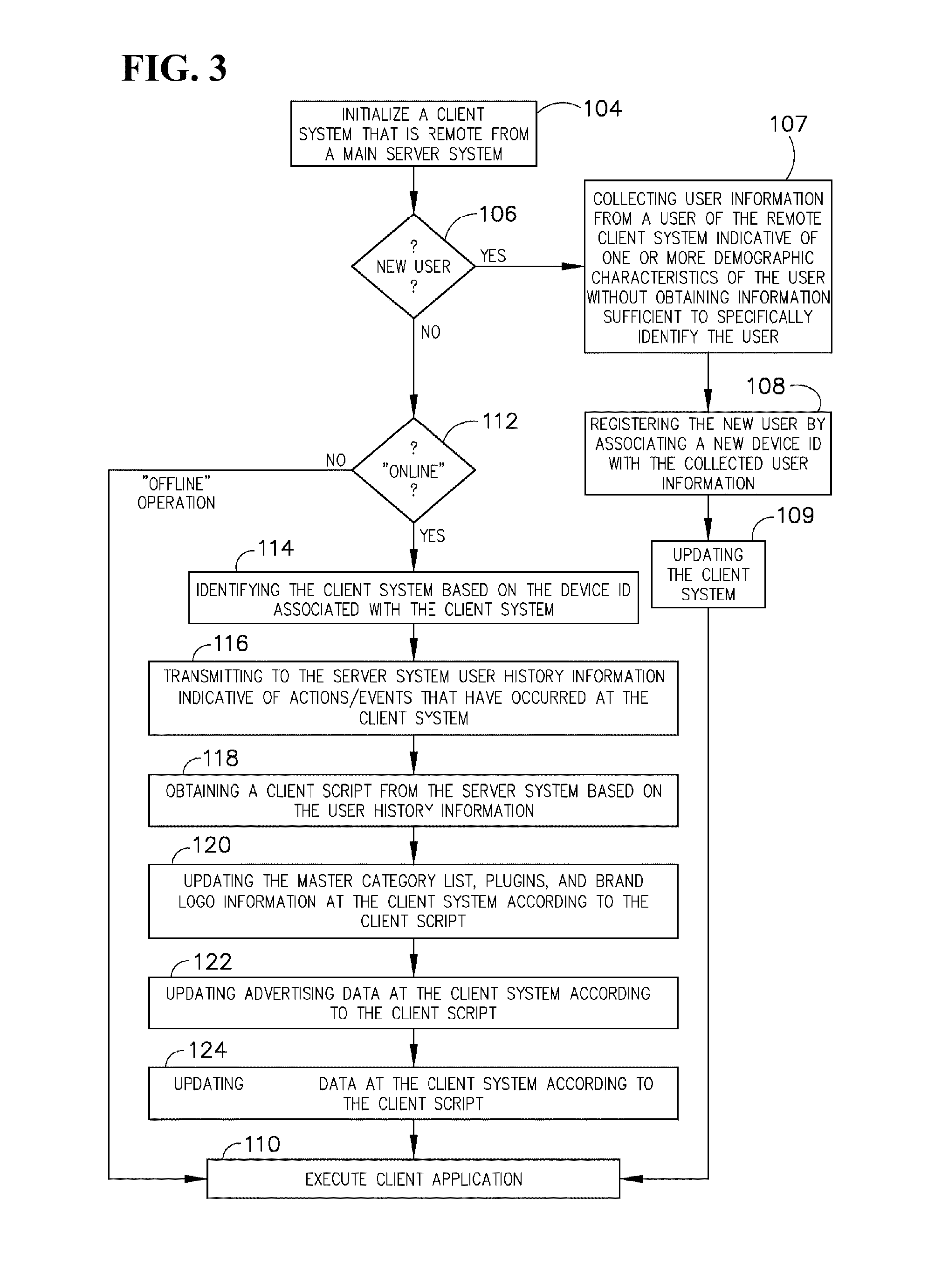

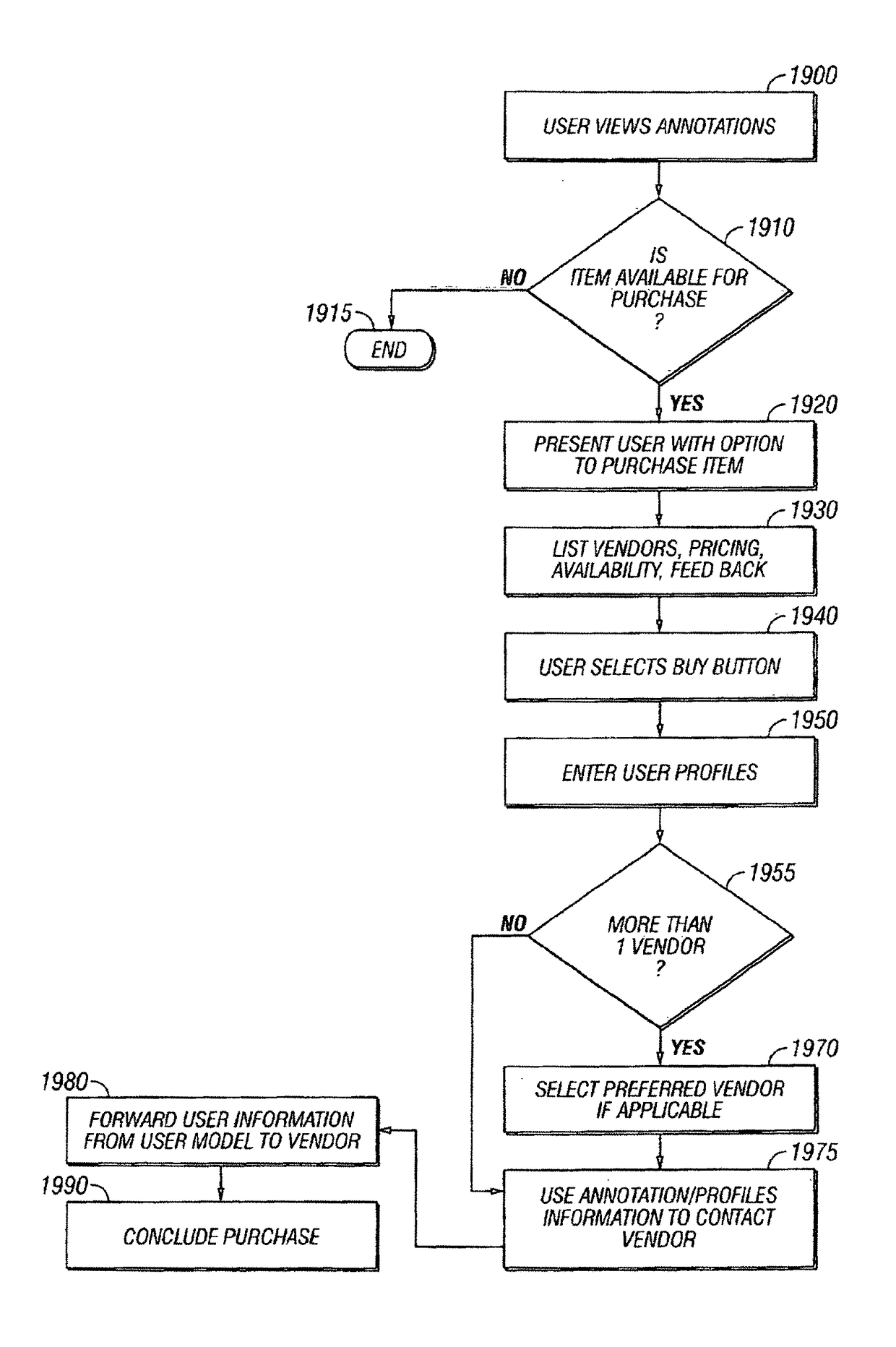

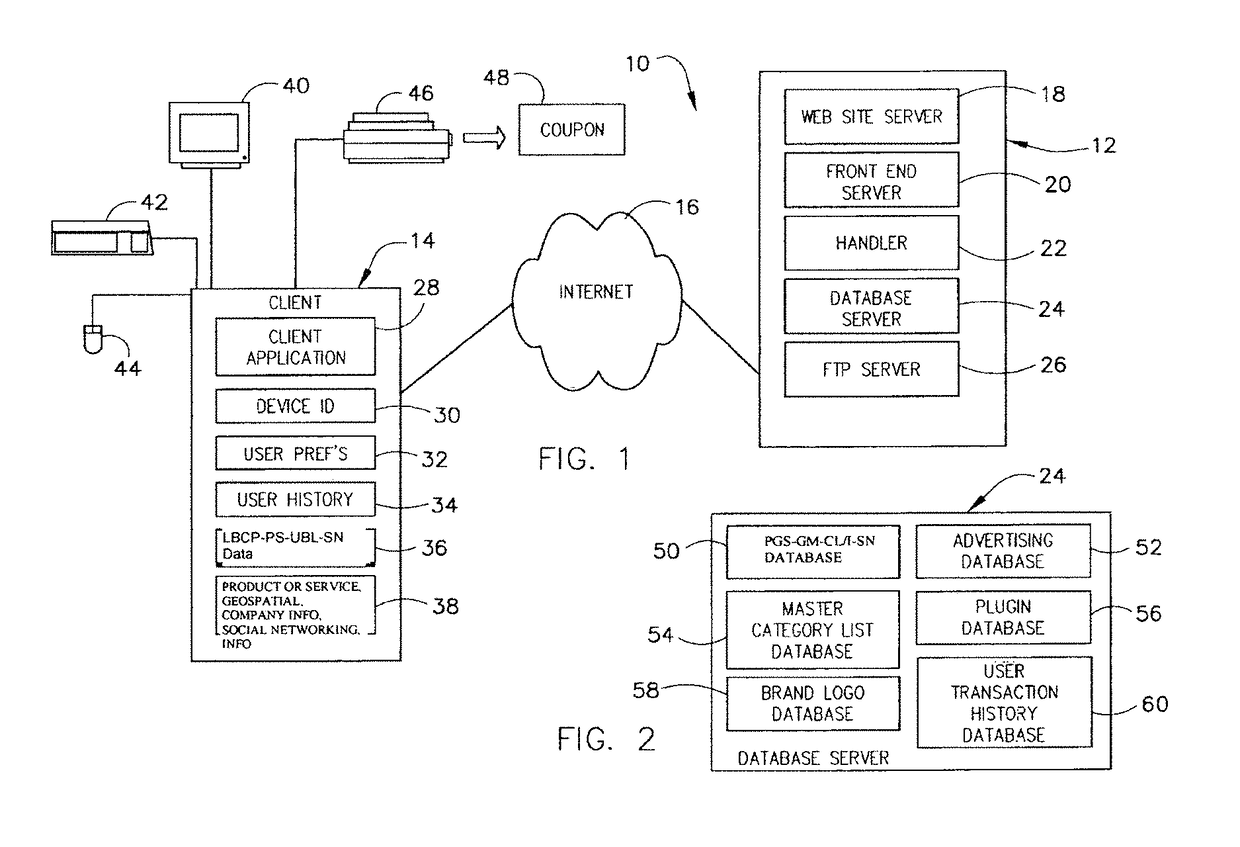

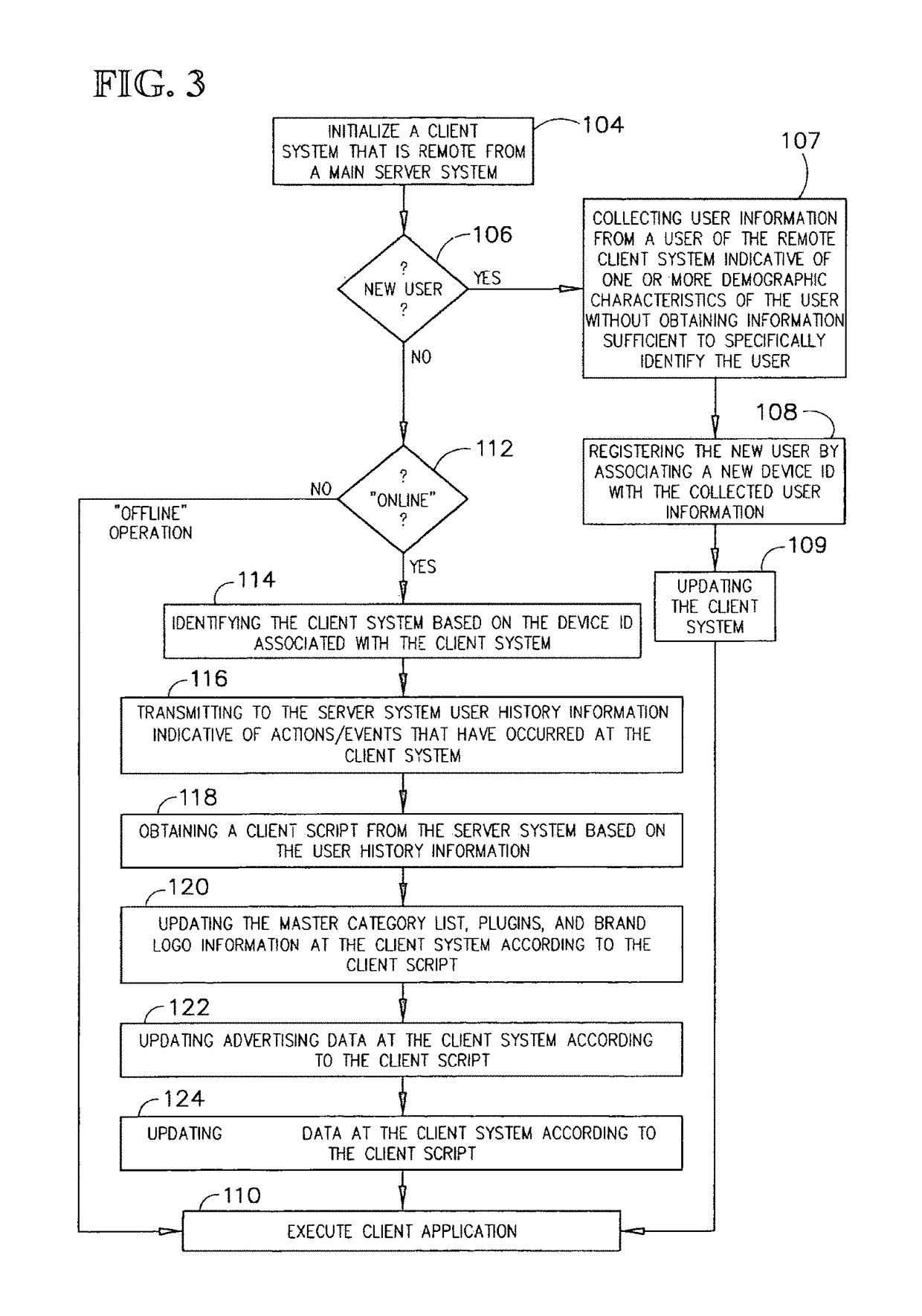

Systems and methods for mobile and online payment systems for purchases related to mobile and online promotions or offers provided using impressions tracking and analysis, location information, 2d and 3D mapping, mobile mapping, social media, and user behavior and information for generating mobile and internet posted promotions or offers for, and/or sales of, products and/or services in a social network, online or via a mobile device

A method, apparatus, computer readable medium, computer system, network, or system is provided for mobile and online payment systems for mobile and online promotions or offers or daily deal coupons or daily deal coupons aggregation provided using impressions tracking and analysis, location information, 2D and 3D mapping, social media, and user behavior and information for generating mobile and internet posted promotions or offers or daily deal coupons or daily deal coupons aggregation for, and / or sales of, products and / or services in a social network, online or via a mobile device-for mobile and web based promotions or offers that connect information and user behavior data to a user or related demographic location or user specified or predicted demographic location(s) for targeted promotions or offers for products and / or services in a social network, online or via a mobile device.

Owner:HEATH STEPHAN

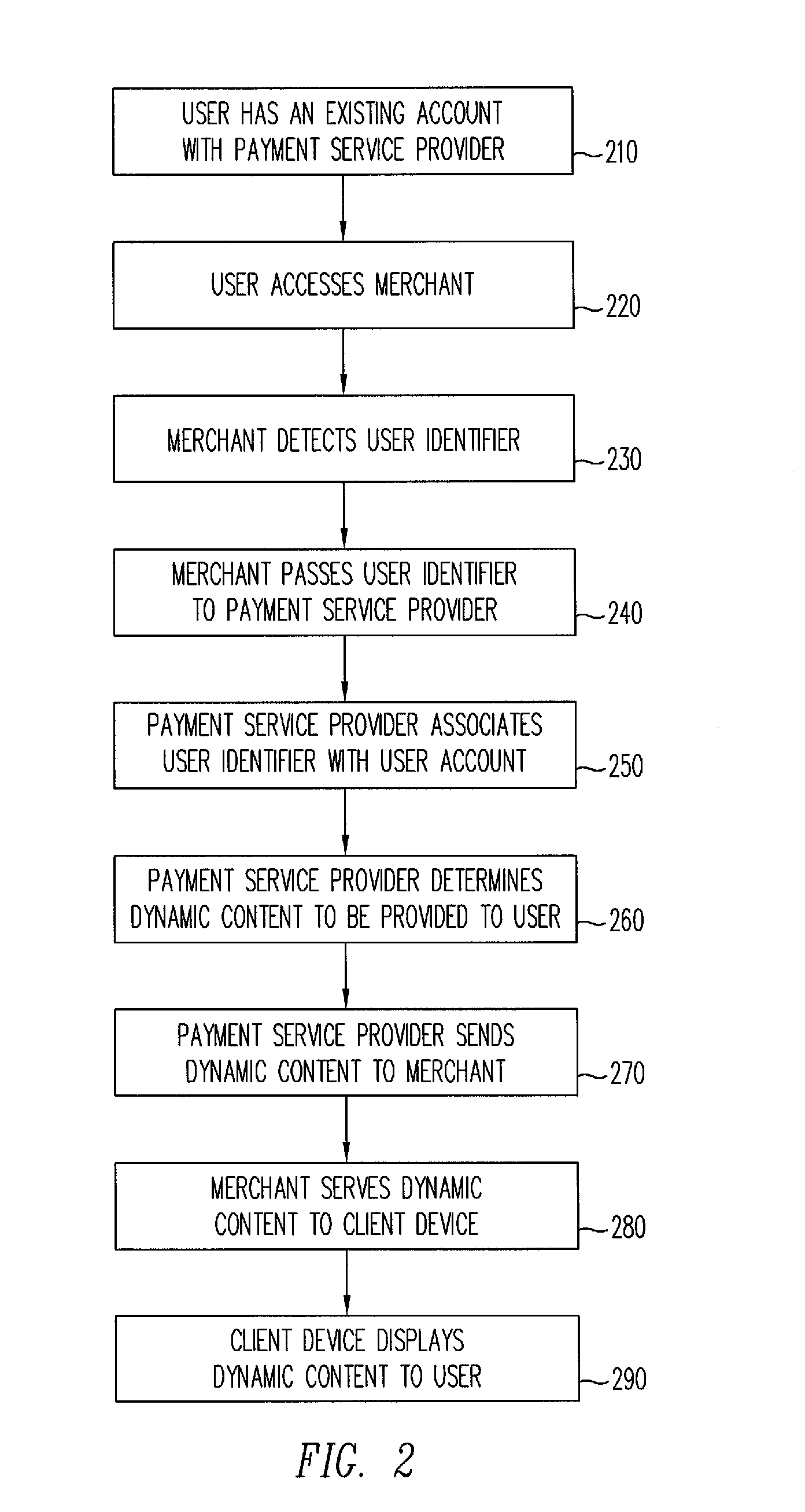

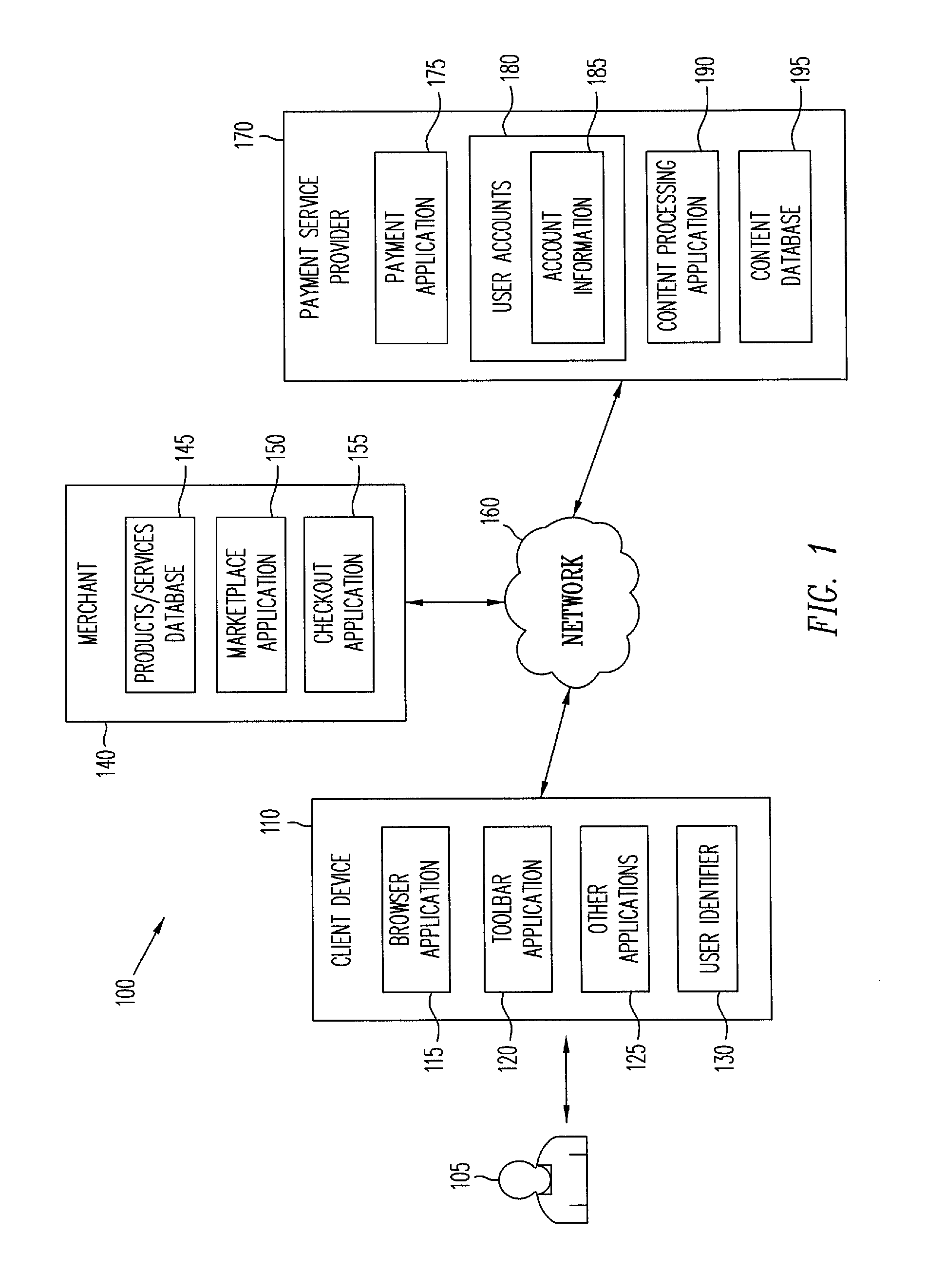

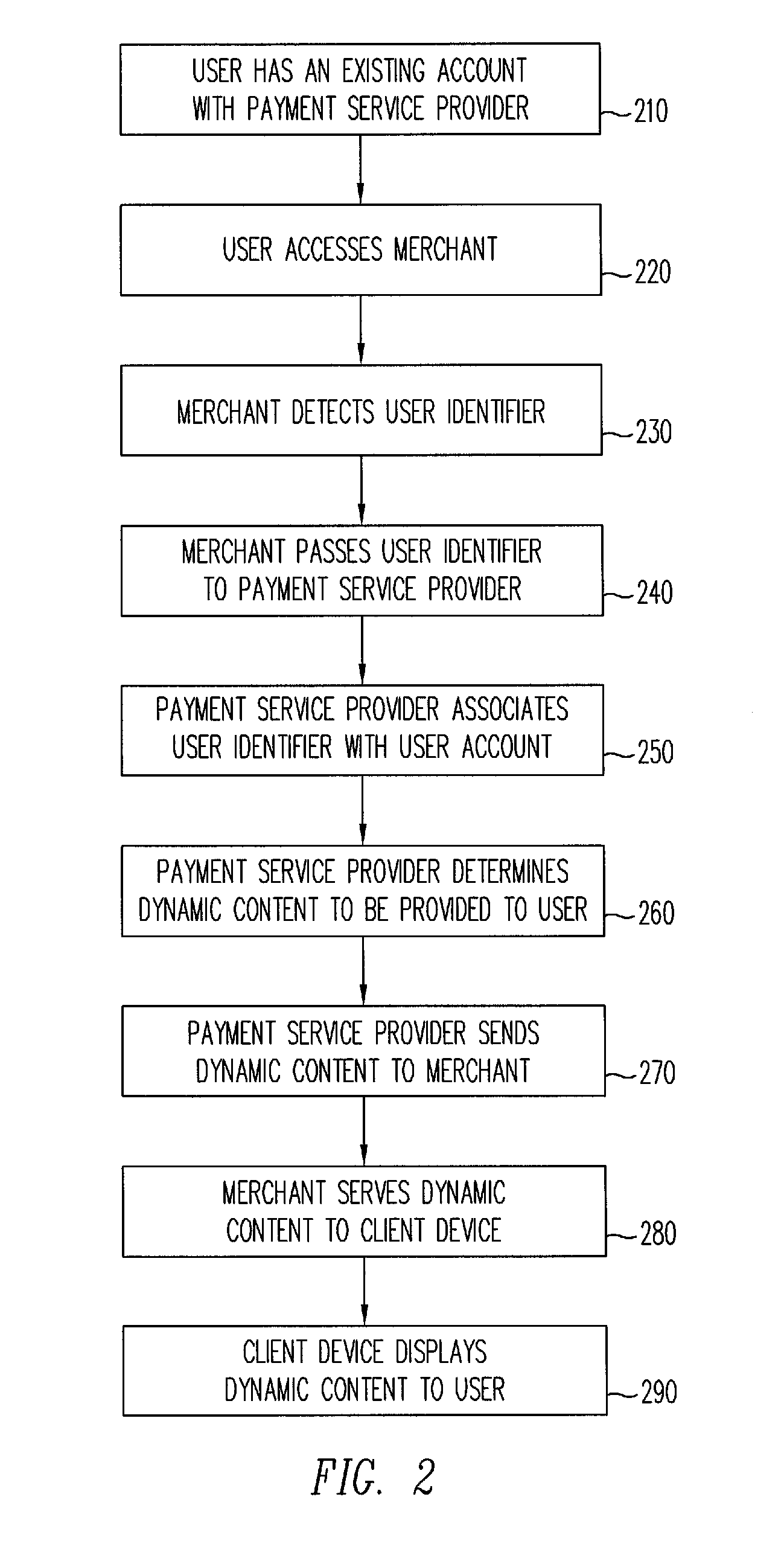

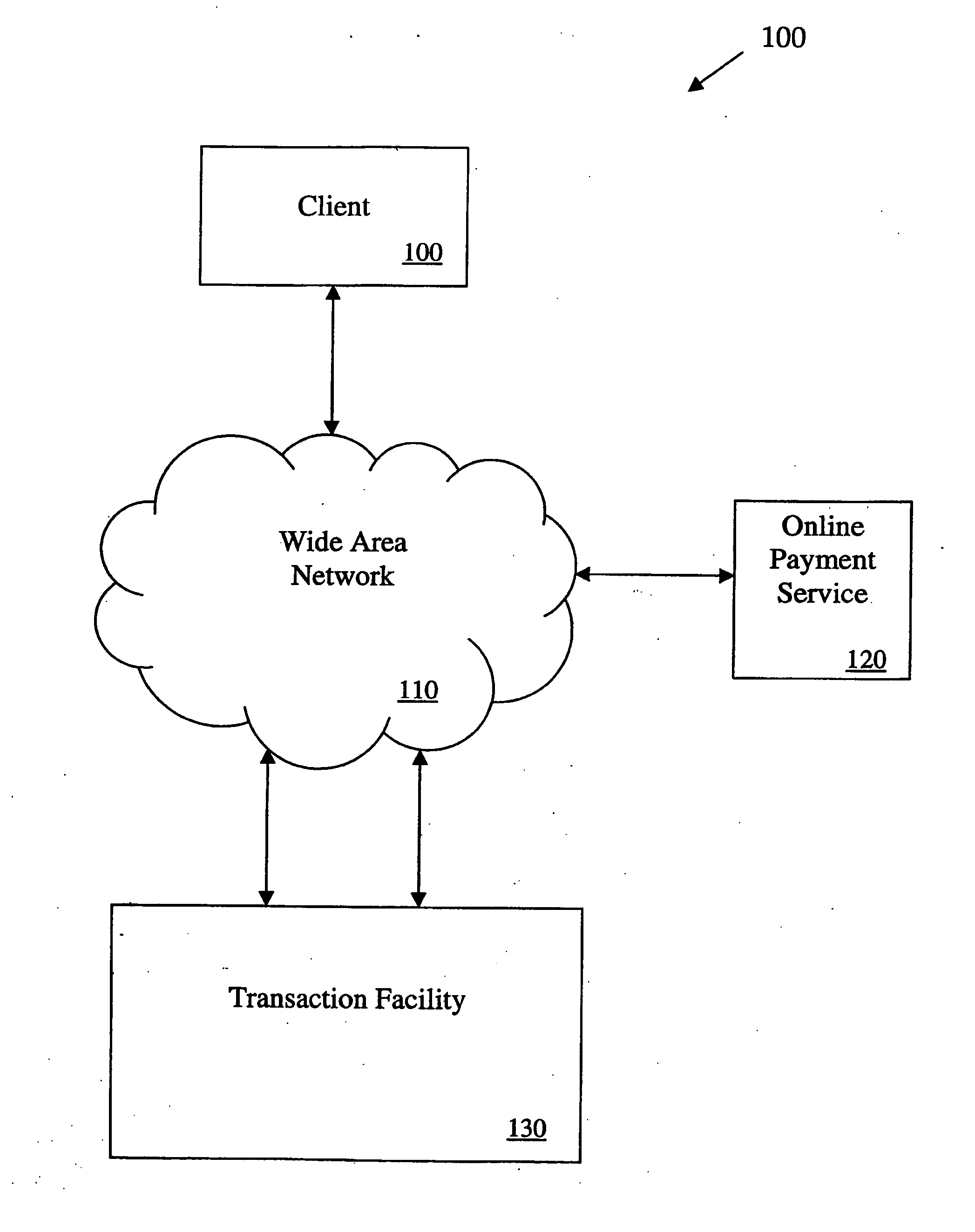

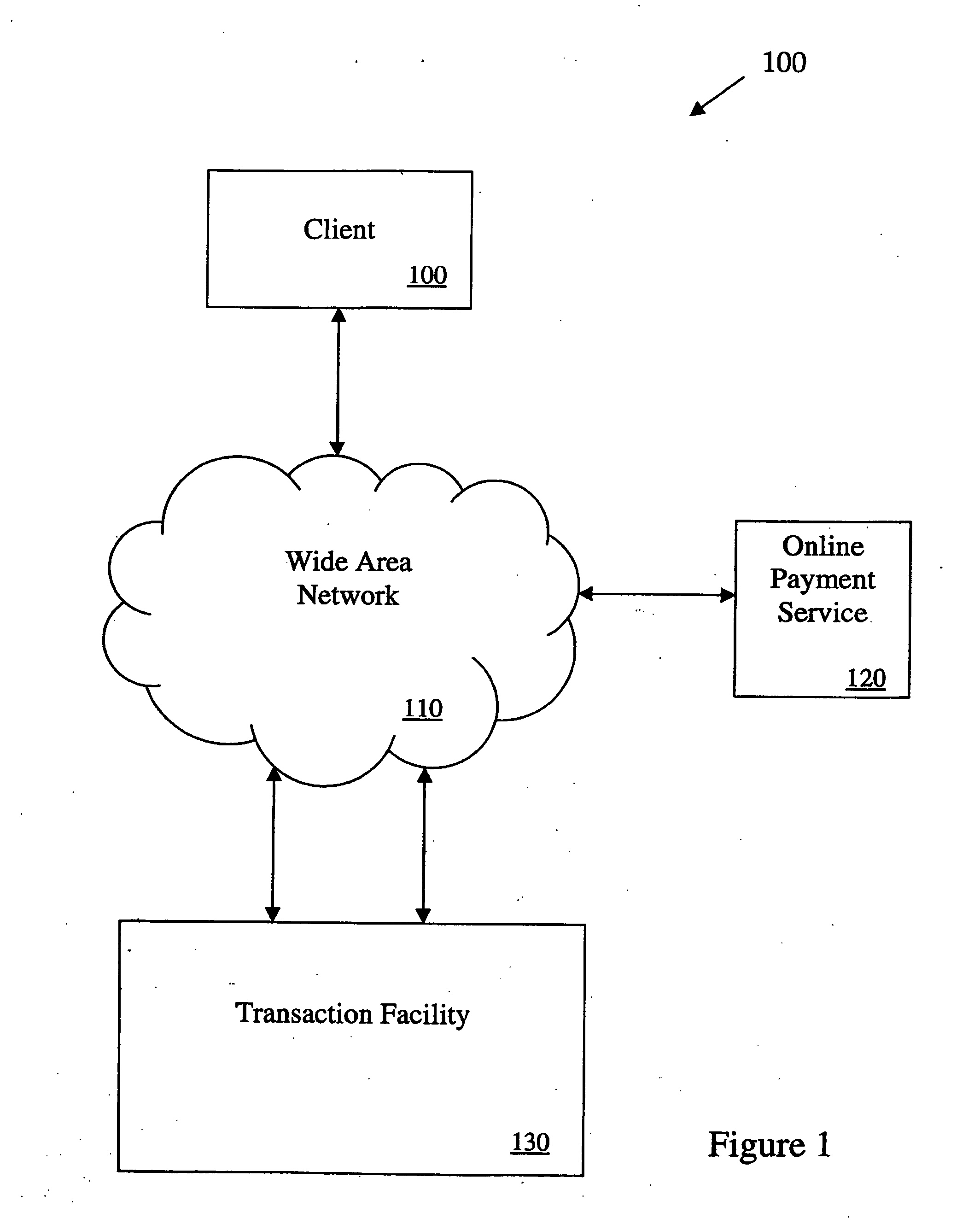

Dynamic content for online transactions

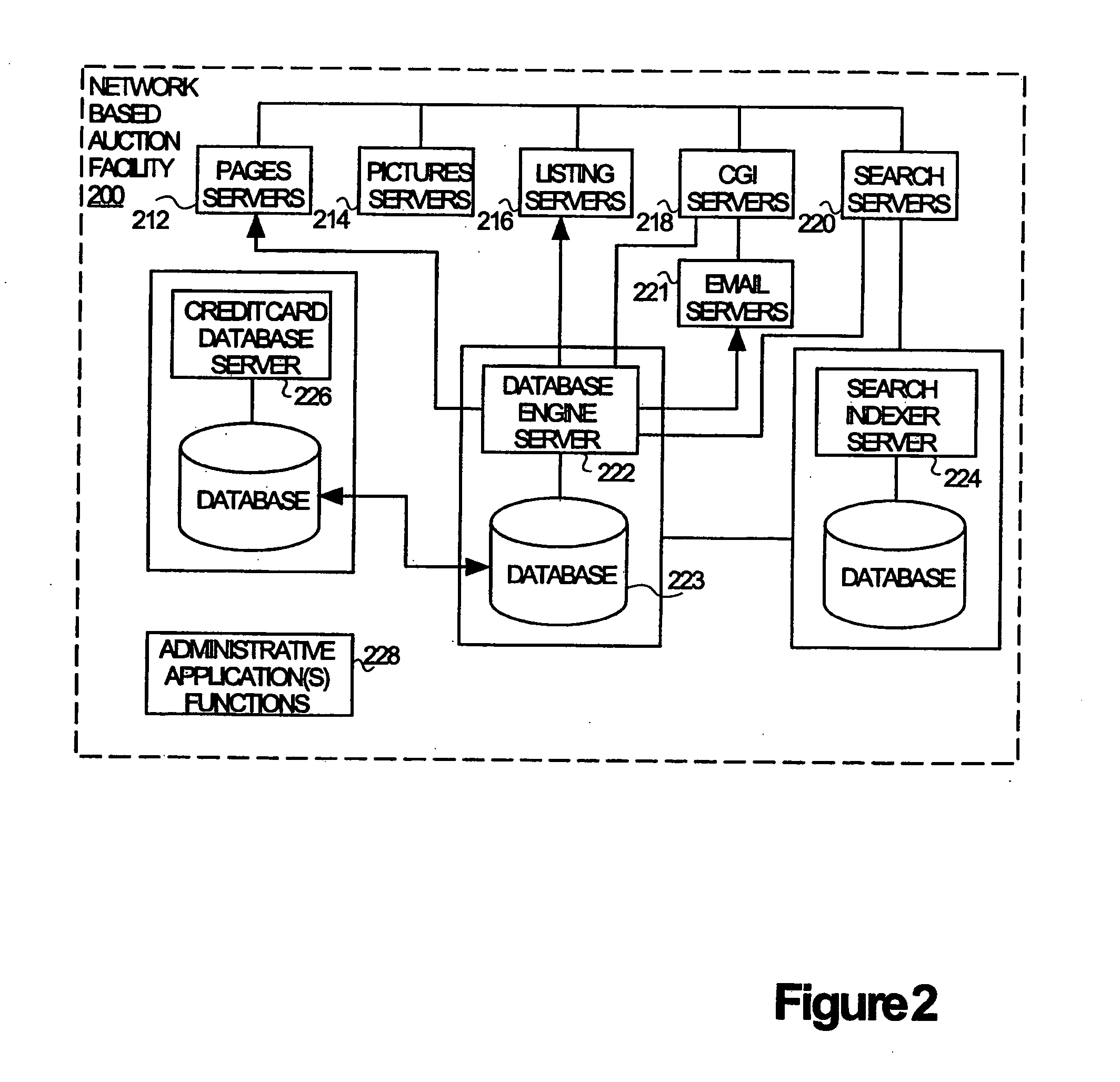

ActiveUS8028041B2Promote disseminationFinanceMultiple digital computer combinationsClient-sideUser identifier

Various methods and systems provide dynamic content to users of online payment service providers without requiring users to log in or otherwise actively engage the payment service providers. In one example, a method includes providing a client device with access to an online marketplace over a network. The method also includes facilitating transmission of a user identifier stored by the client device to a payment service provider. The method further includes receiving dynamic content from the payment service provider in response to the user identifier. In addition, the method includes serving the dynamic content to the client device over the network.

Owner:PAYPAL INC

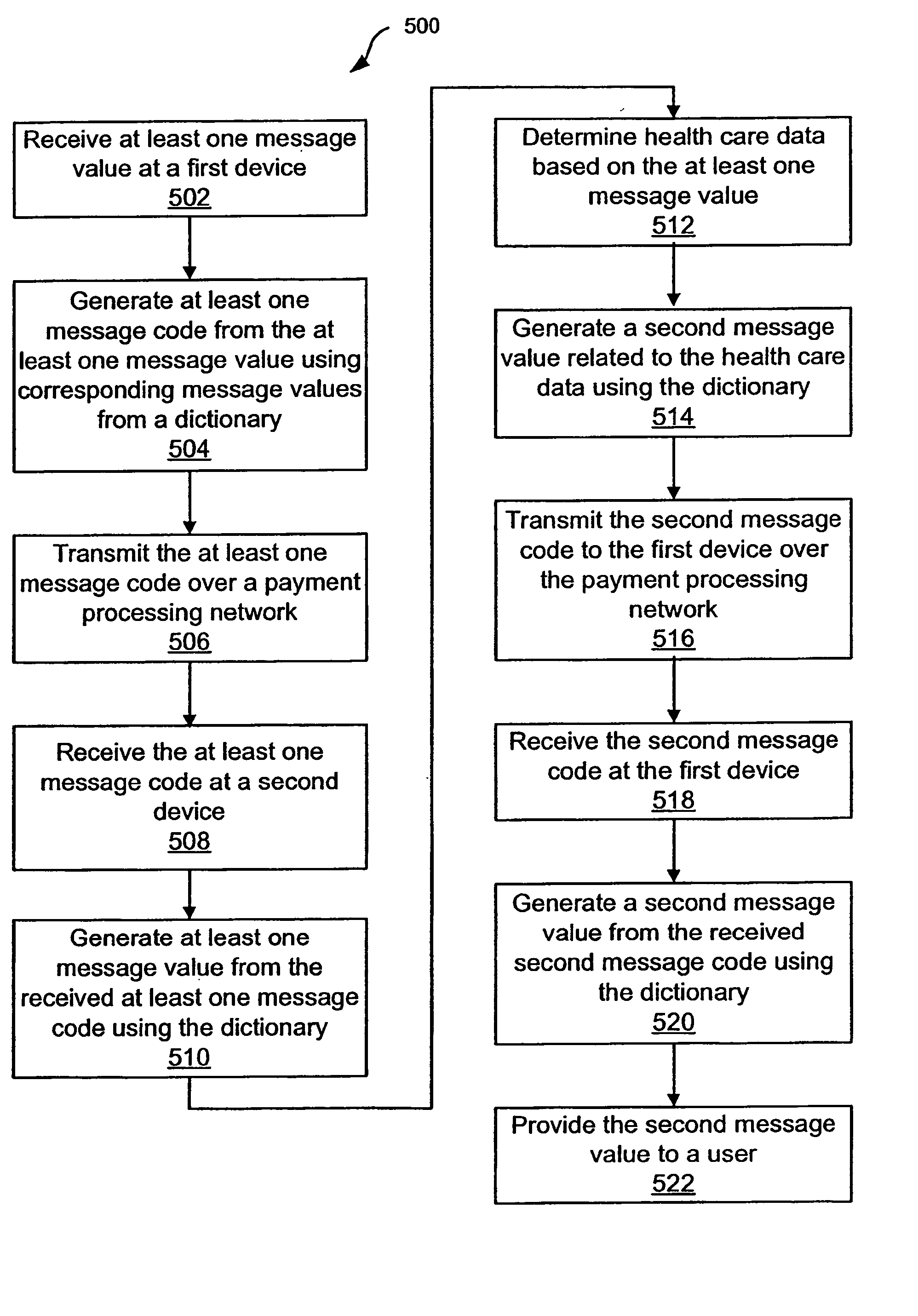

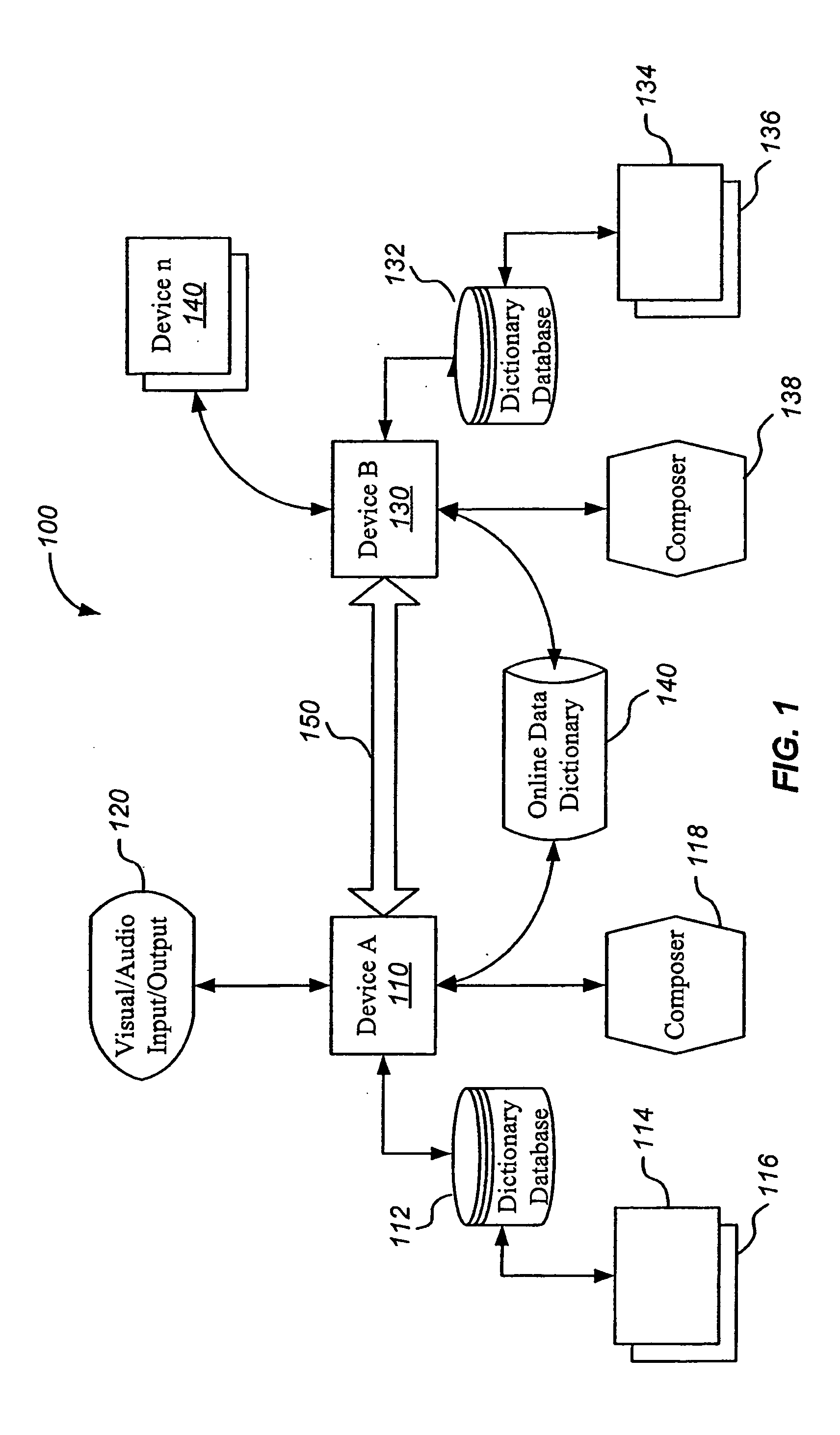

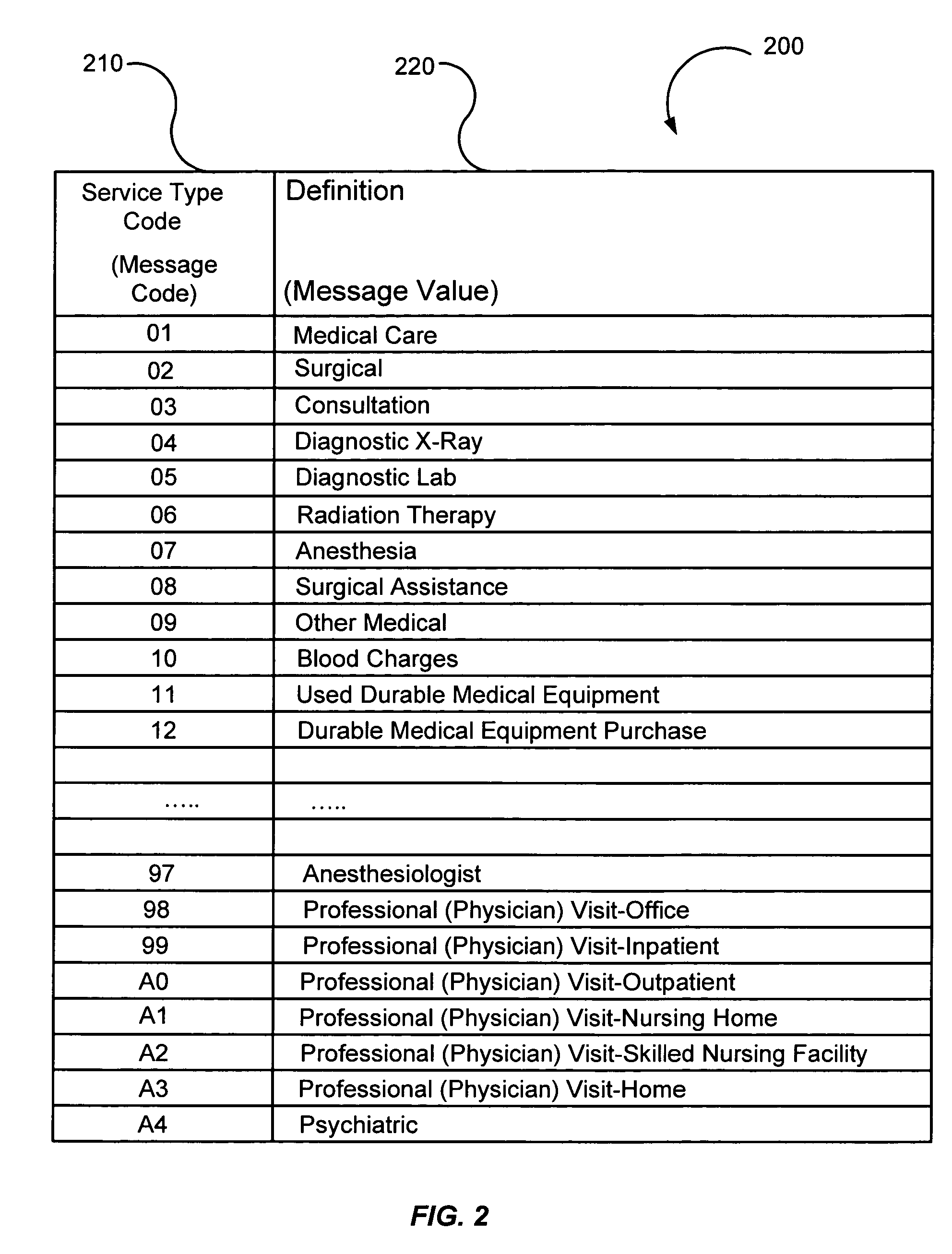

Method for encoding messages between two devices for transmission over standard online payment networks

InactiveUS20060149529A1Reduce data sizeBig amount of dataFinanceOffice automationComputer hardwareOnline payment

A method of using a dictionary of message codes related to health care information is provided. The message codes in the dictionary have corresponding message values. The method includes receiving at least one message value at a first device. The first device then generates at least one message code related to health care information from the at least one message value using corresponding message values from the dictionary. The method also includes transmitting the at least one message code over a payment processing network.

Owner:VISA USA INC (US)

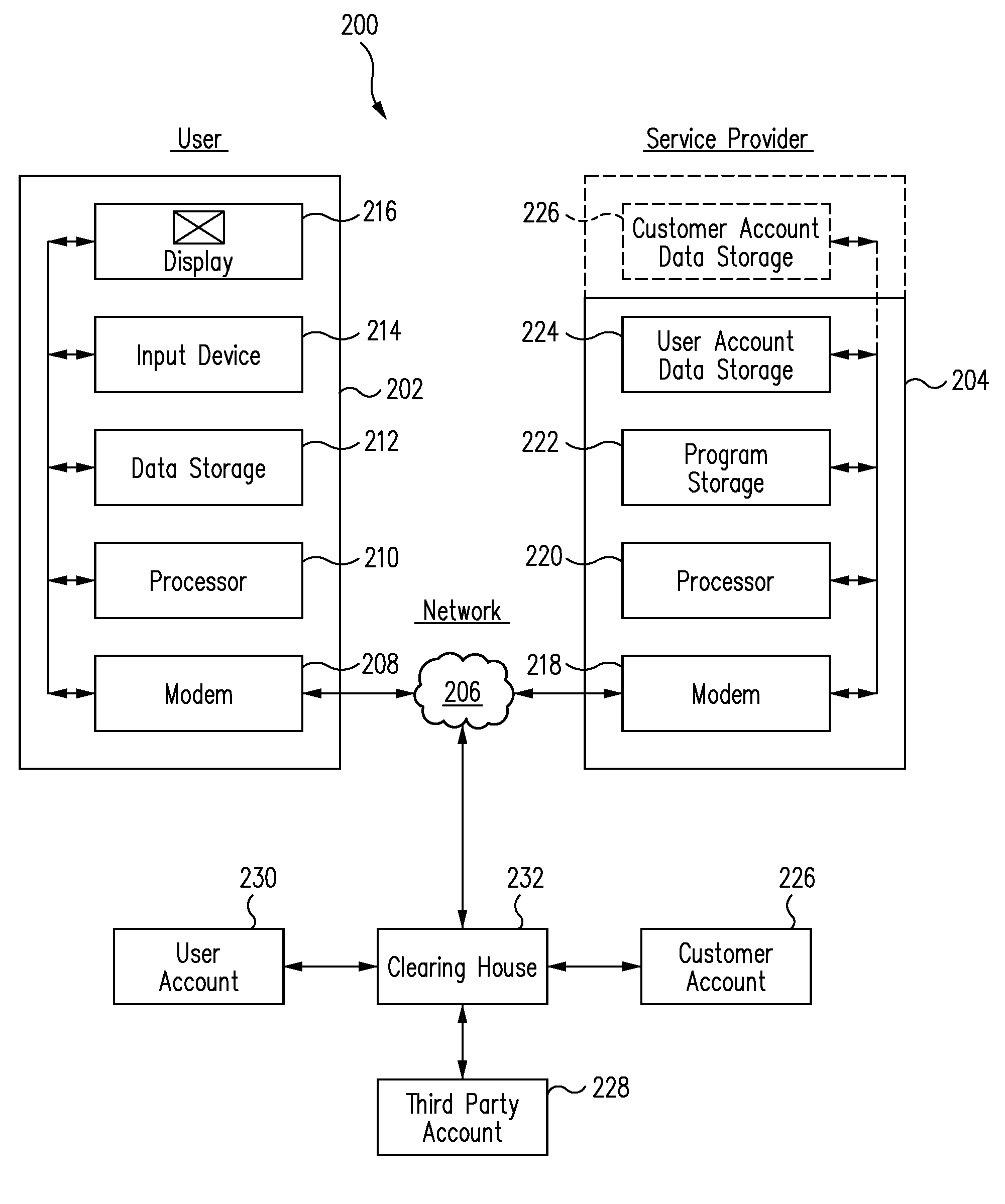

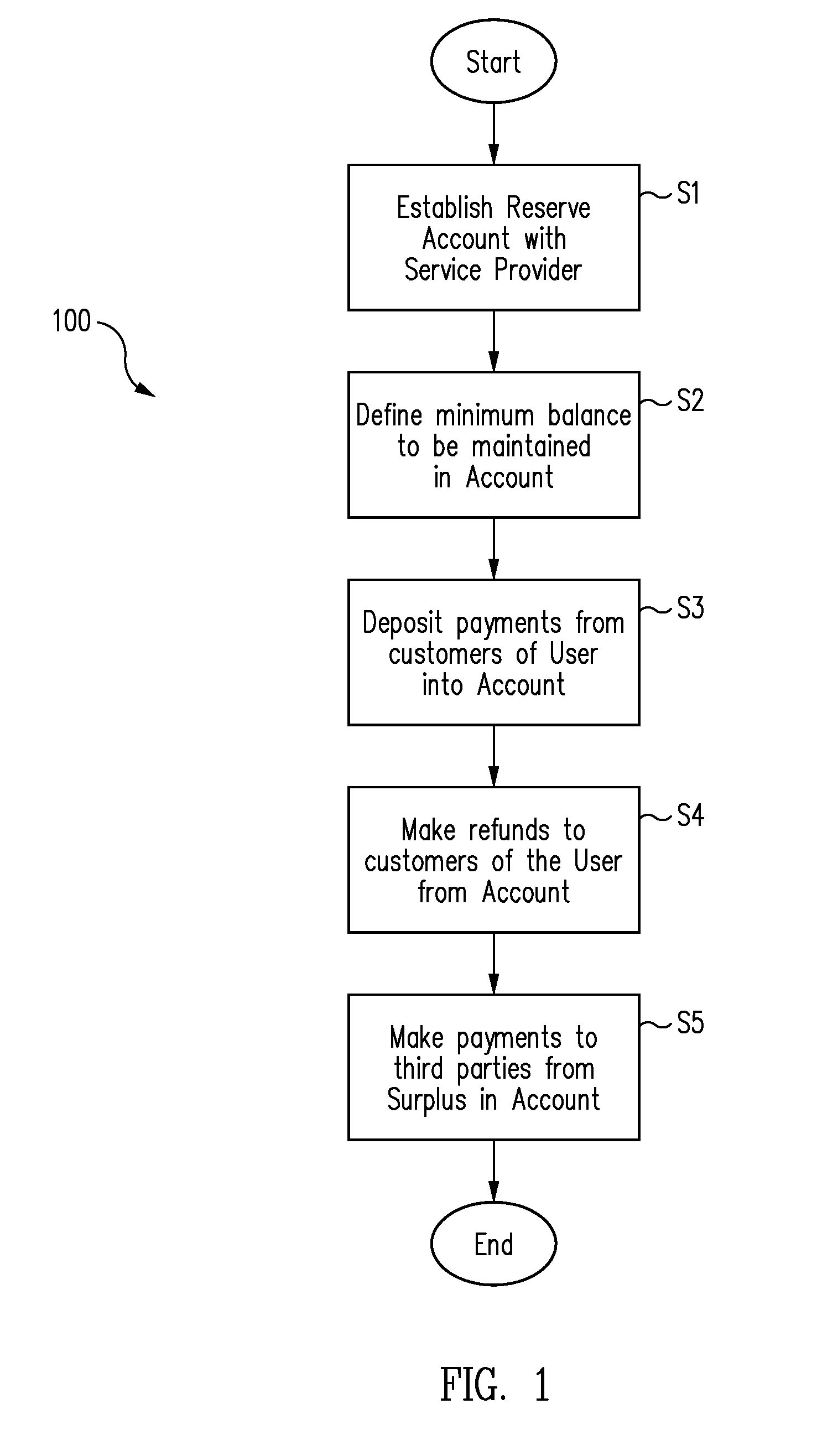

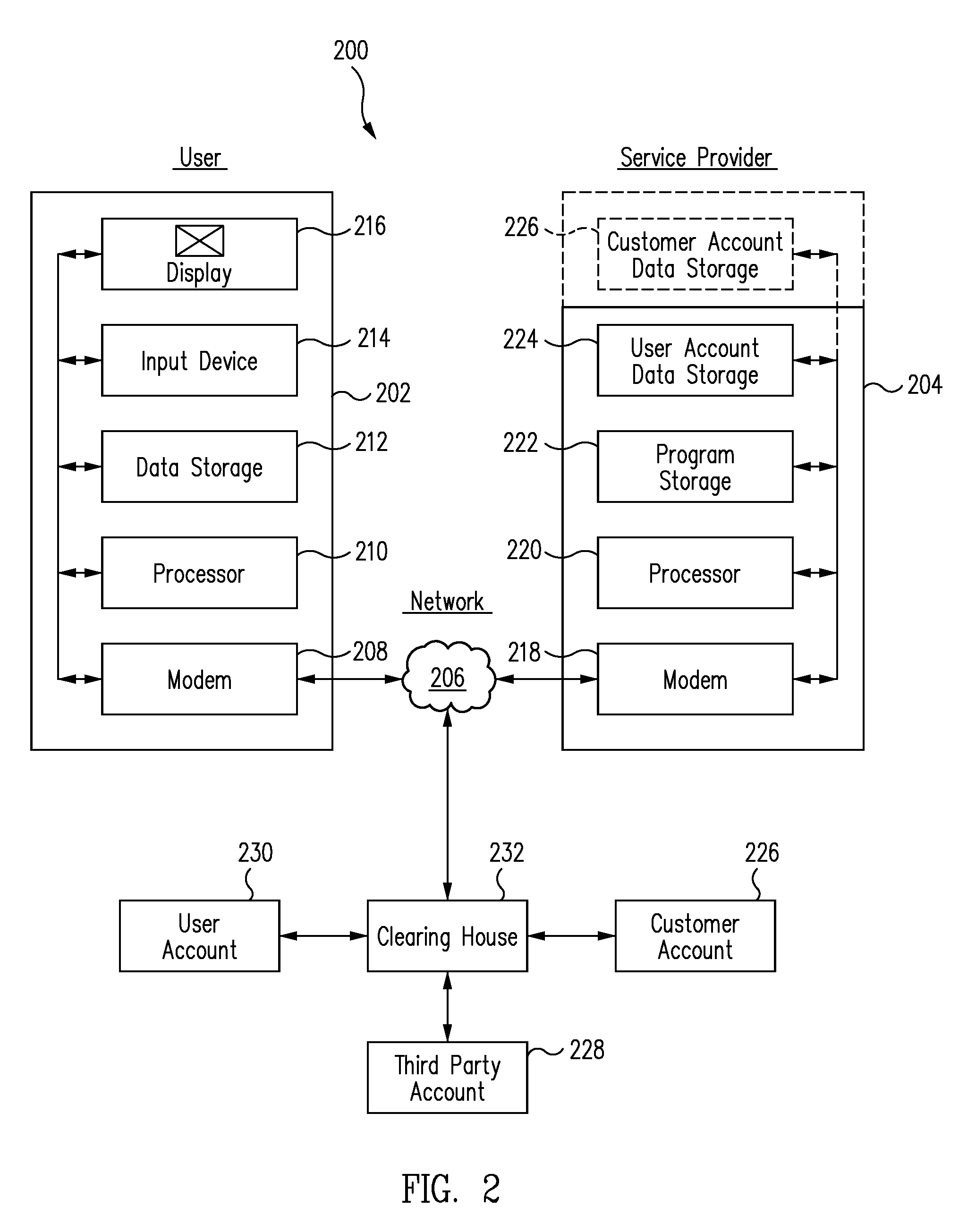

Customer refunds using payment service providers

A method by which a merchant can establish and advantageously use an account at an online payment service provider for making both payments and refunds to customers so as to minimize overdraft or non-sufficient funds (NSF) occurrences and the attendant delays and loss of customer good will includes providing at least one processor communicating through at least one network, and using the at least one processor and network to receive a refund request, access a user reserve account with an online payment service provider, wherein the reserve account is associated with a regular account of the user with the payment service provider, and processing the refund request from the reserve account.

Owner:PAYPAL INC

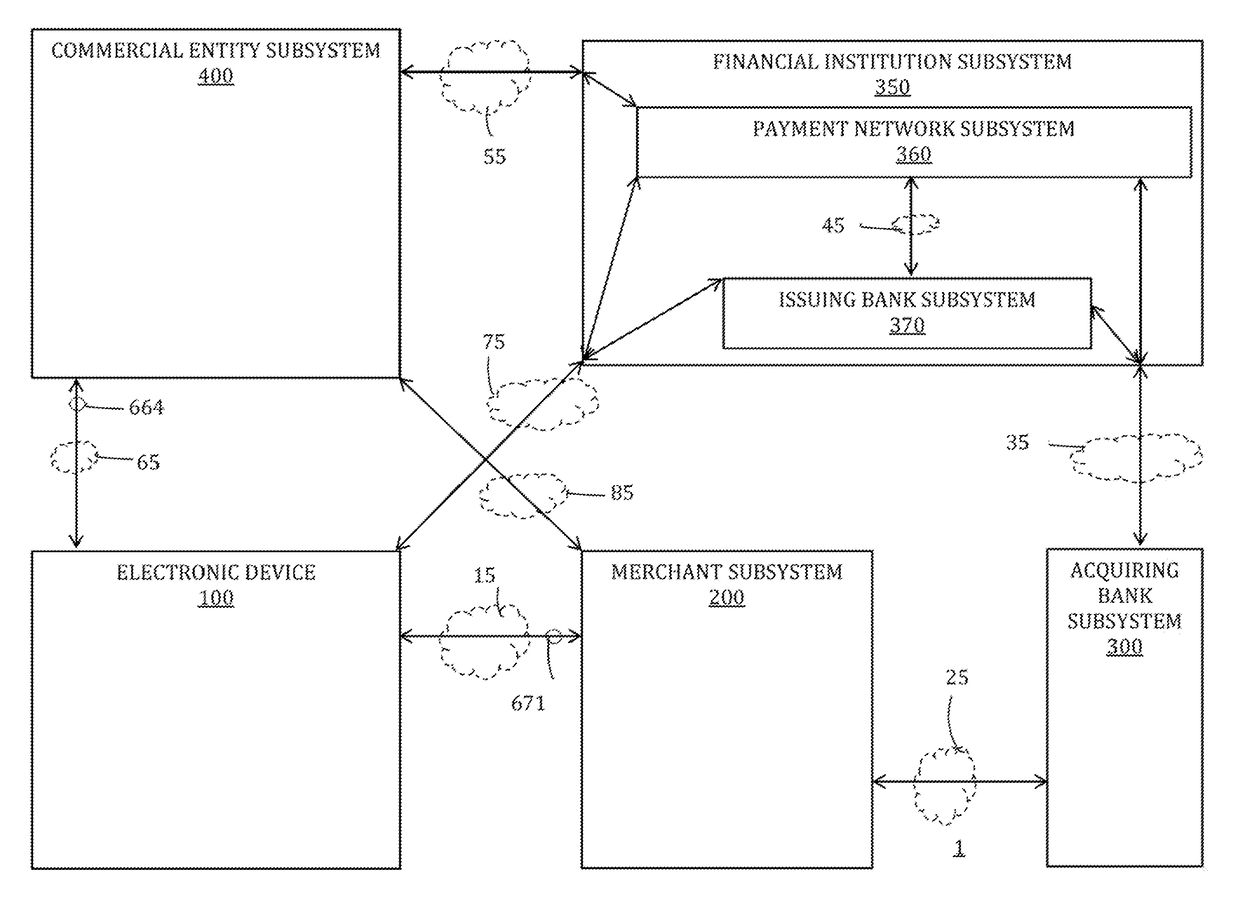

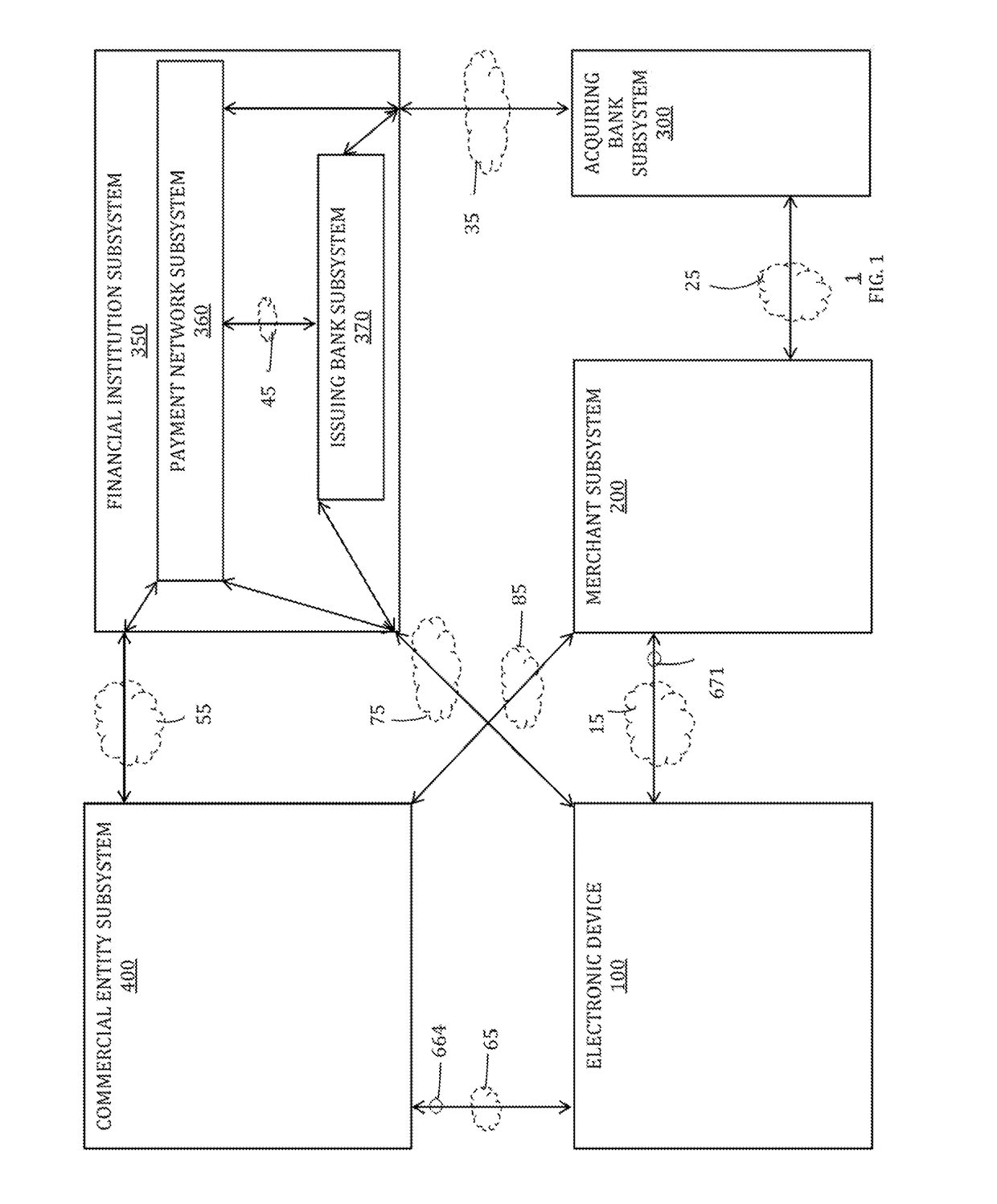

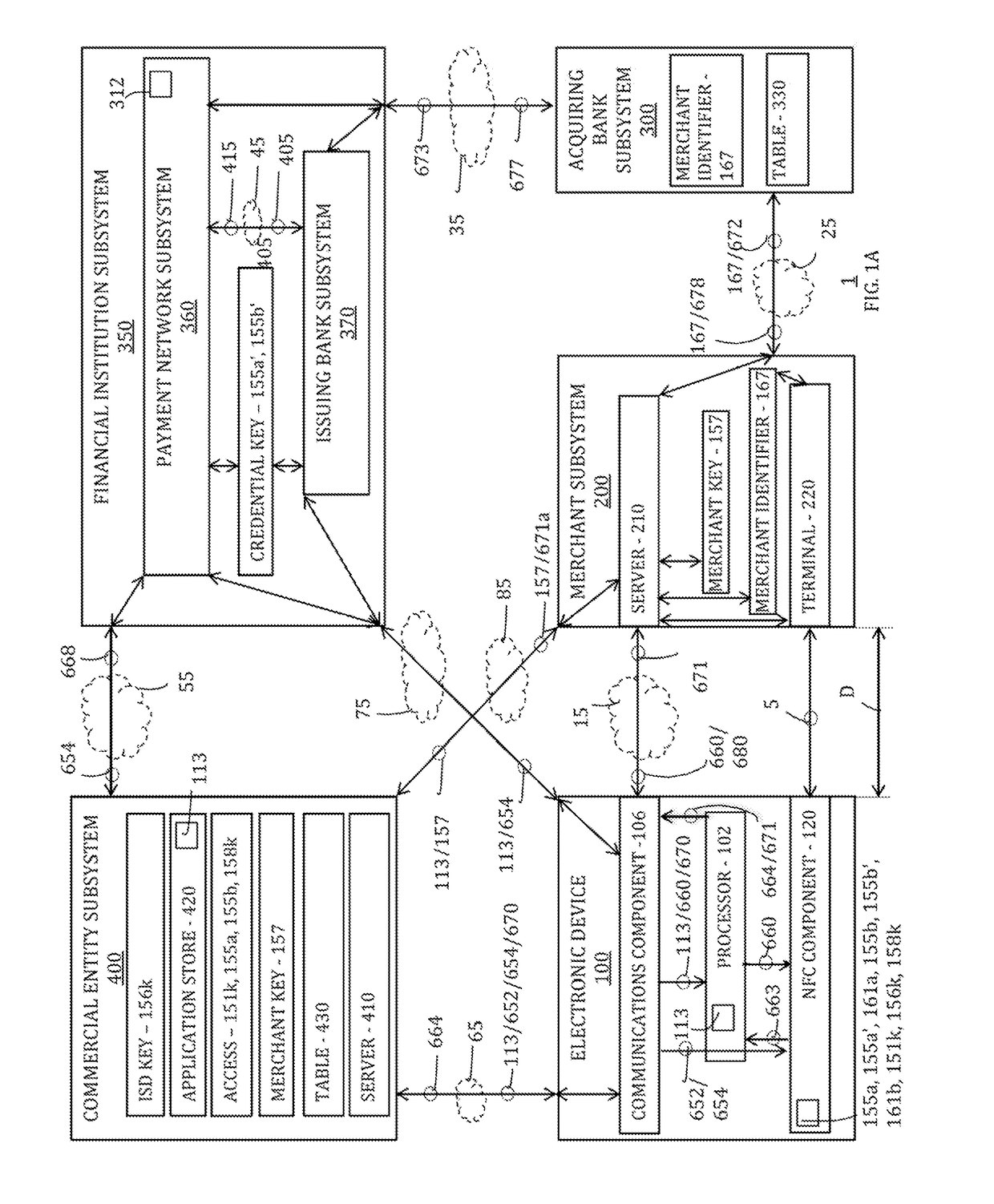

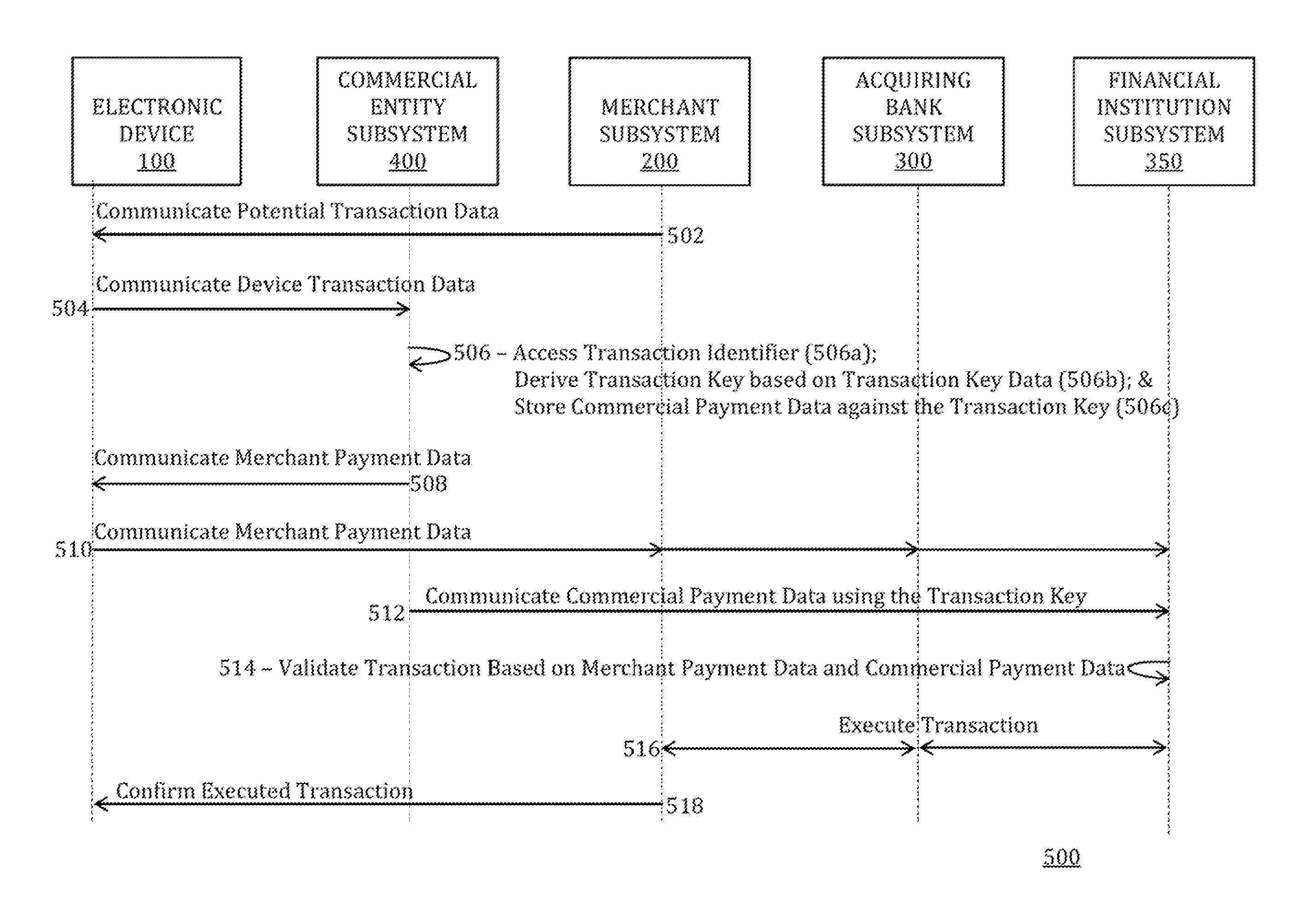

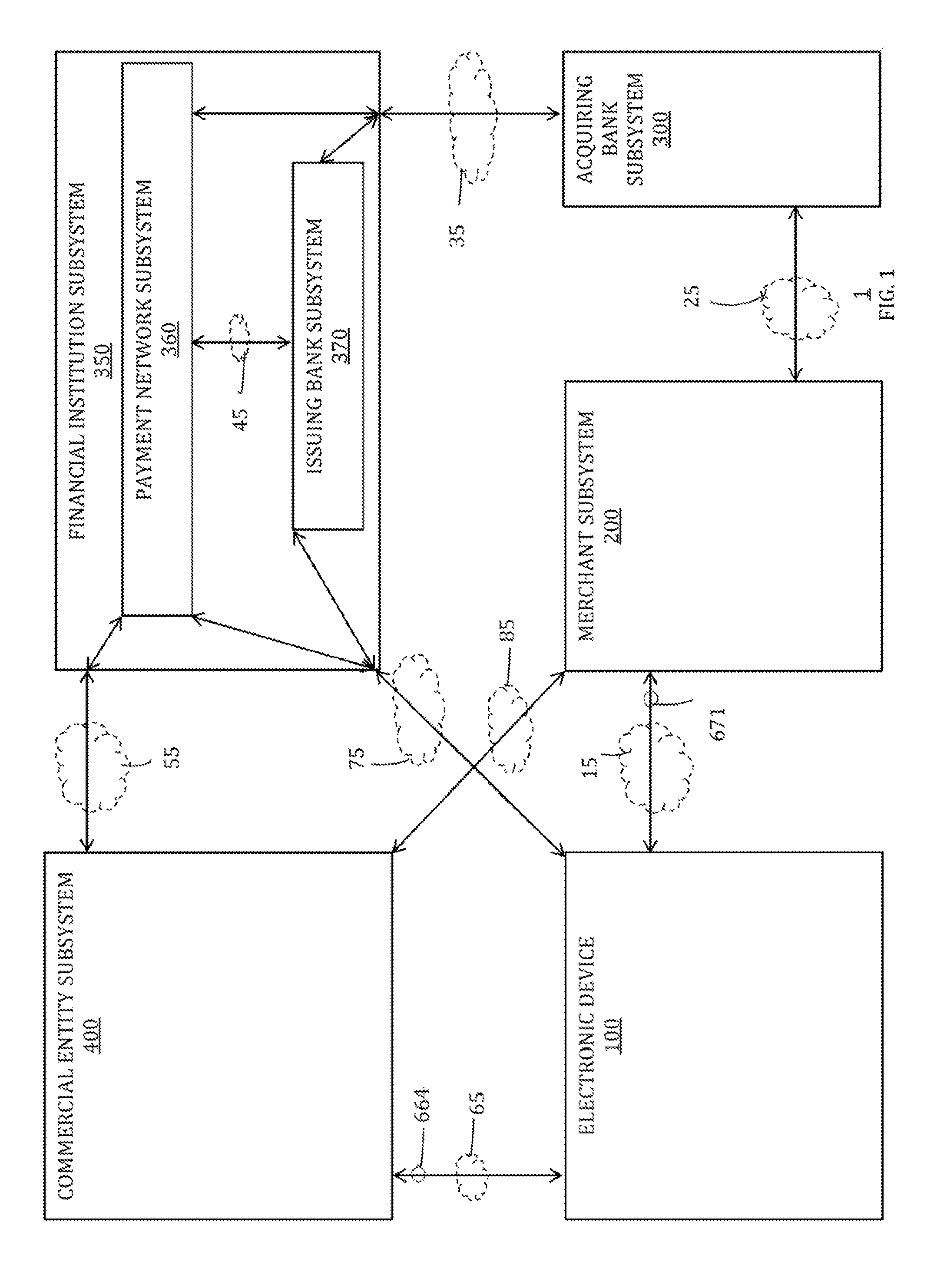

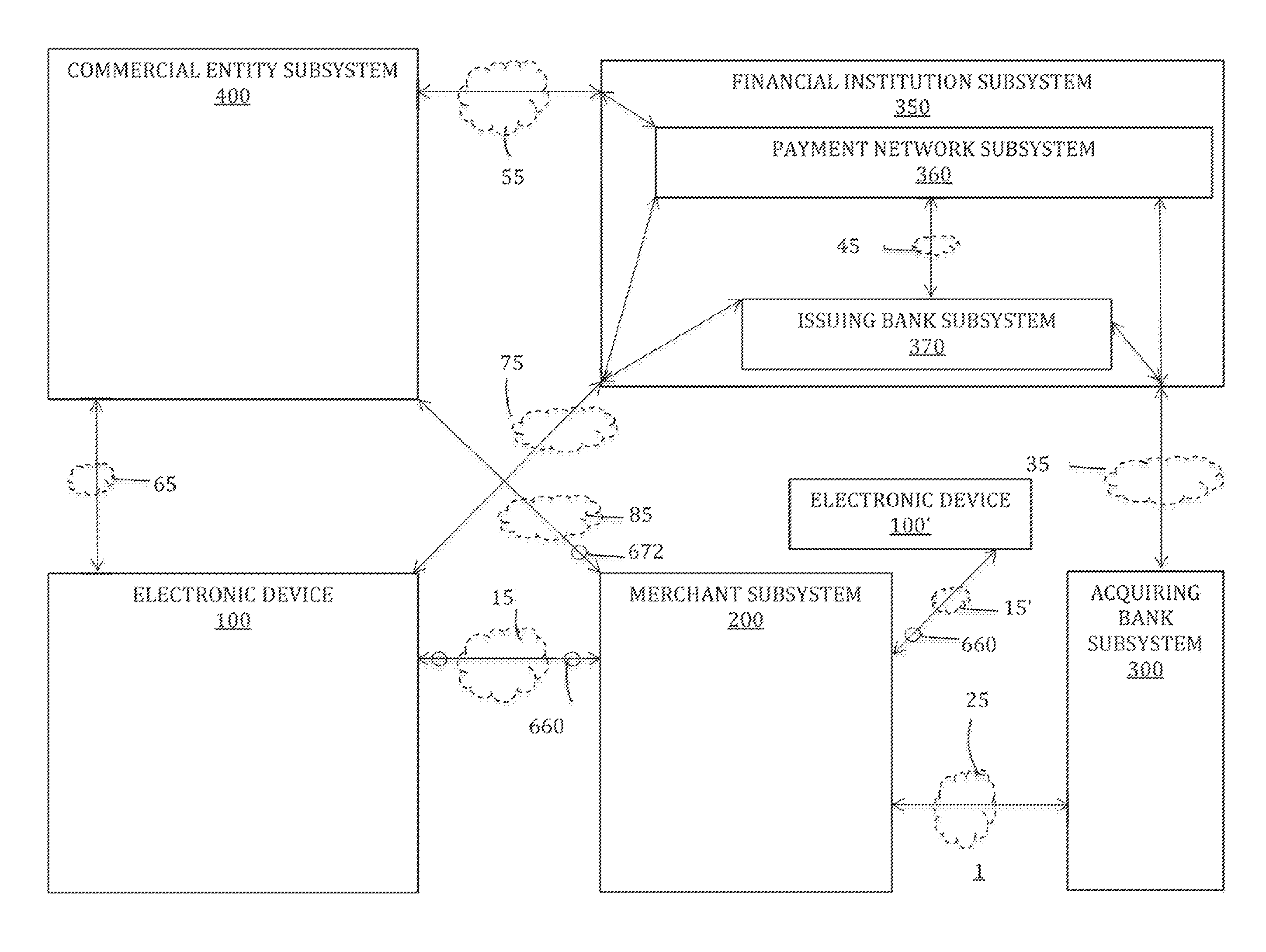

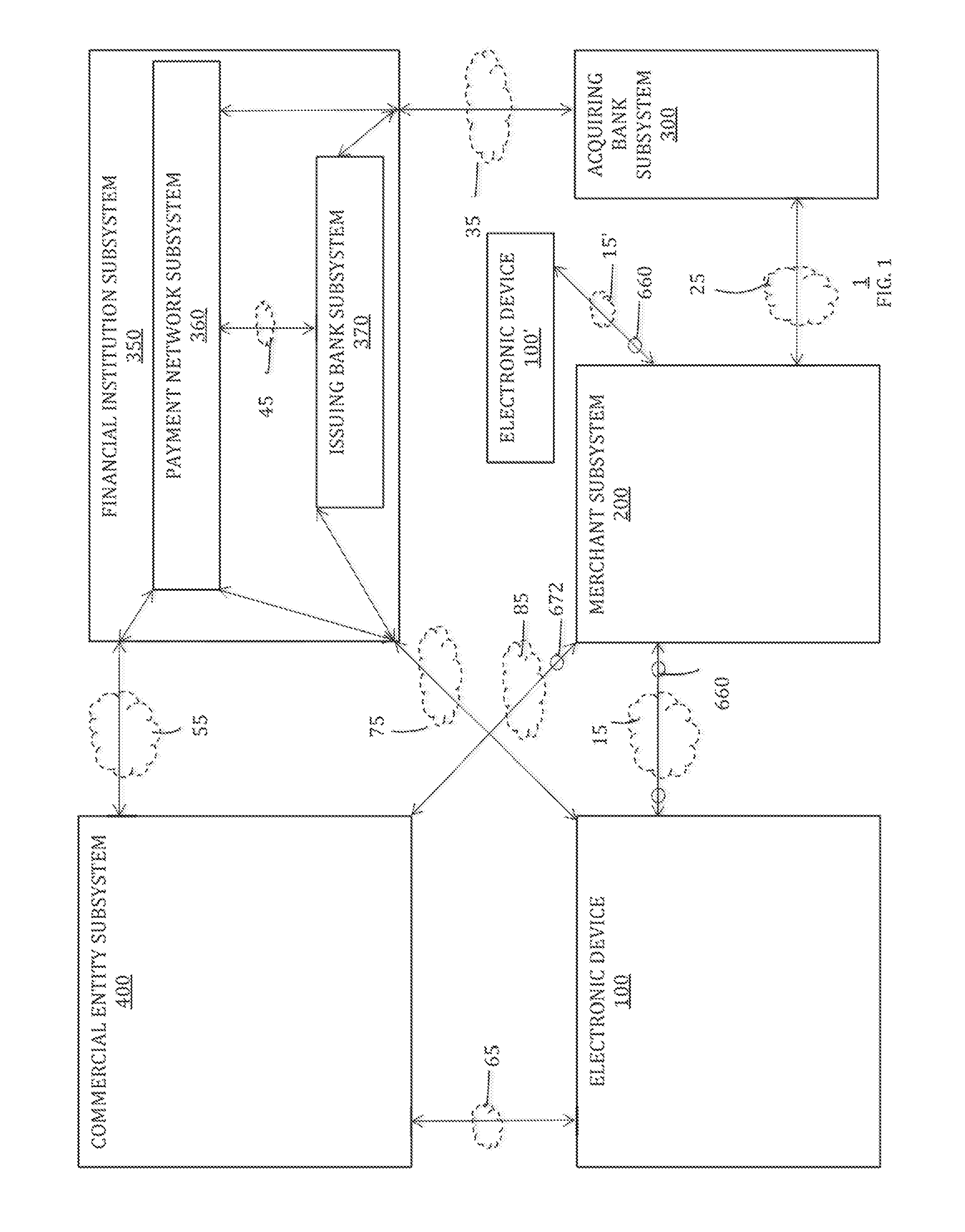

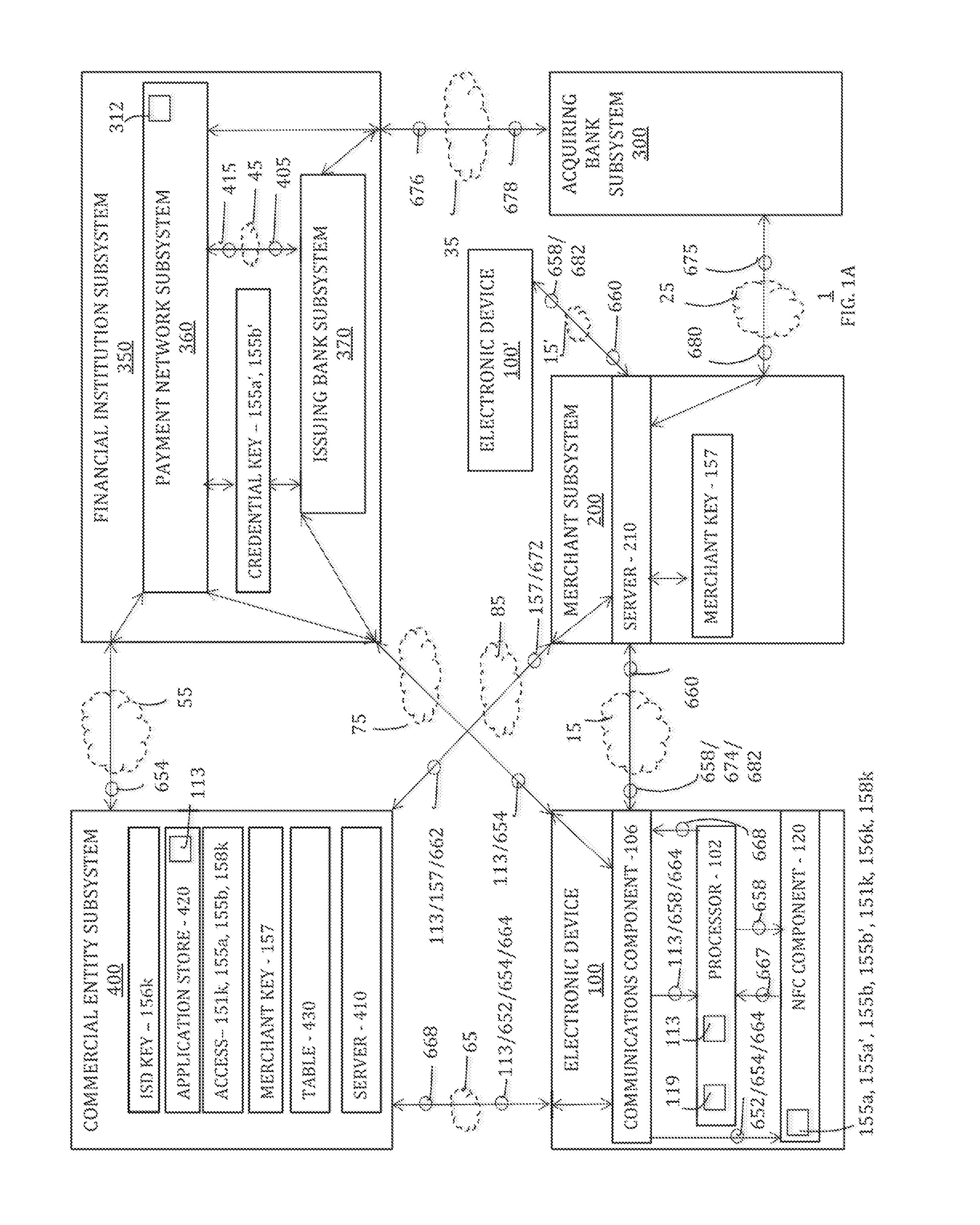

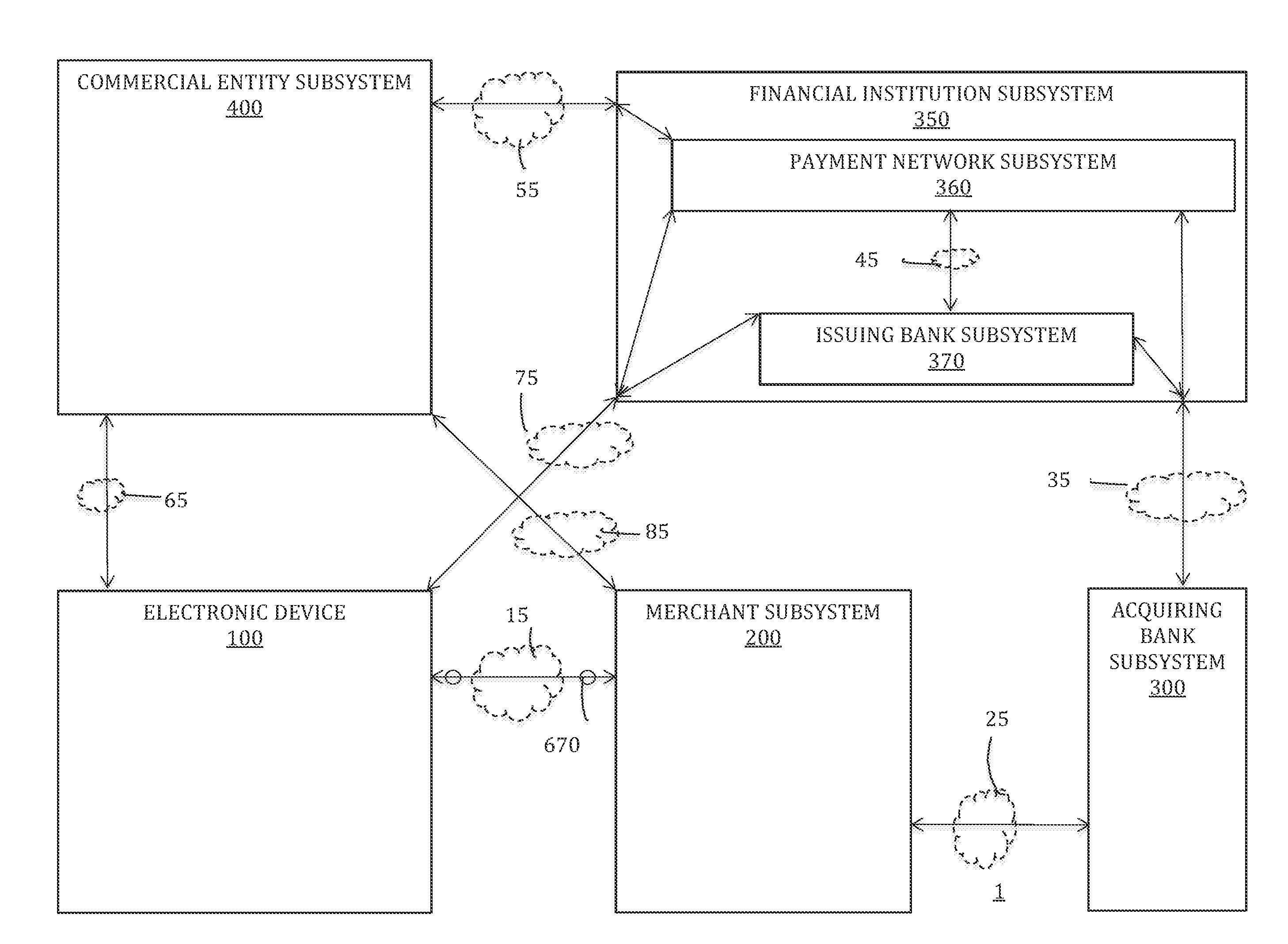

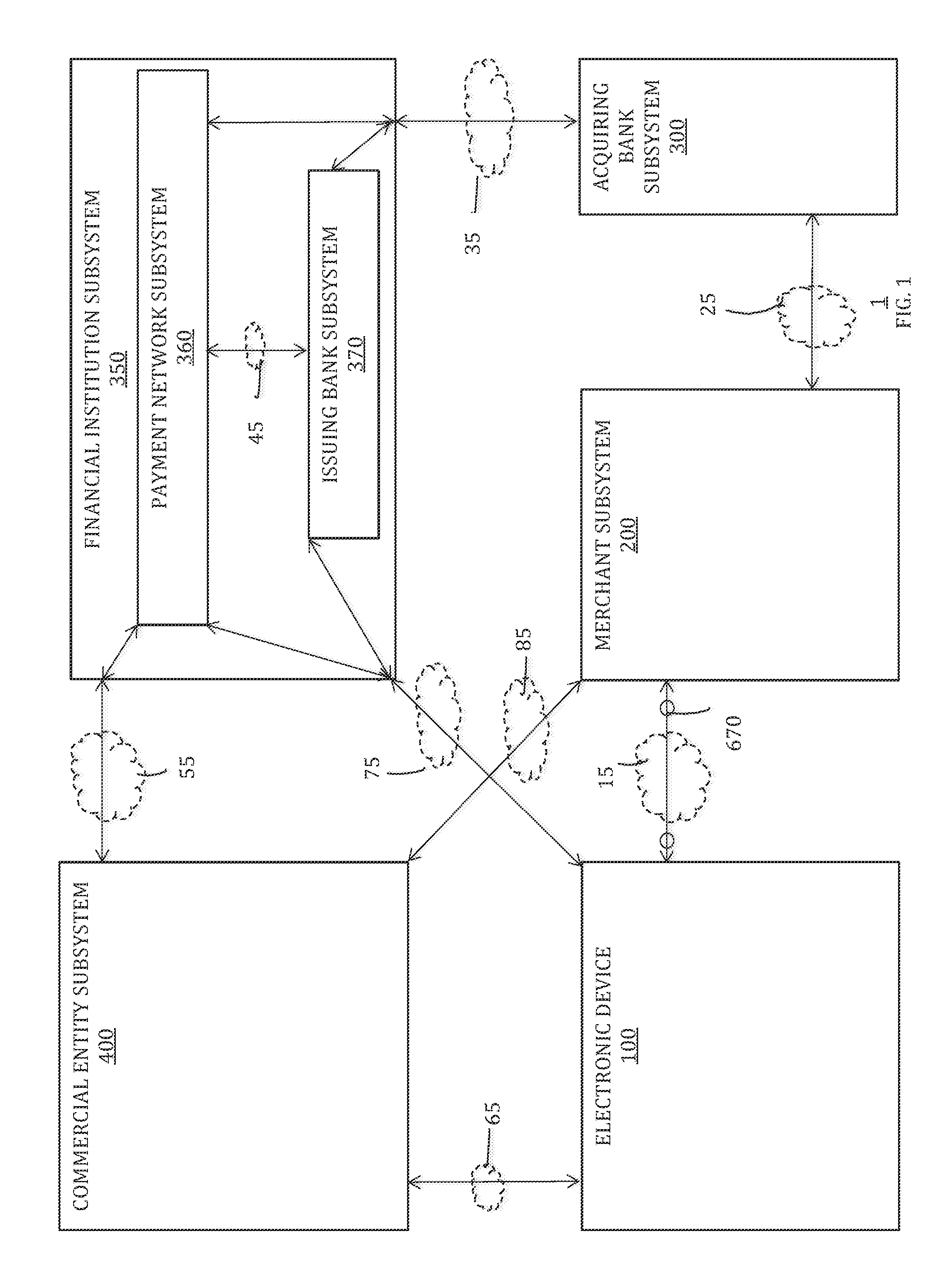

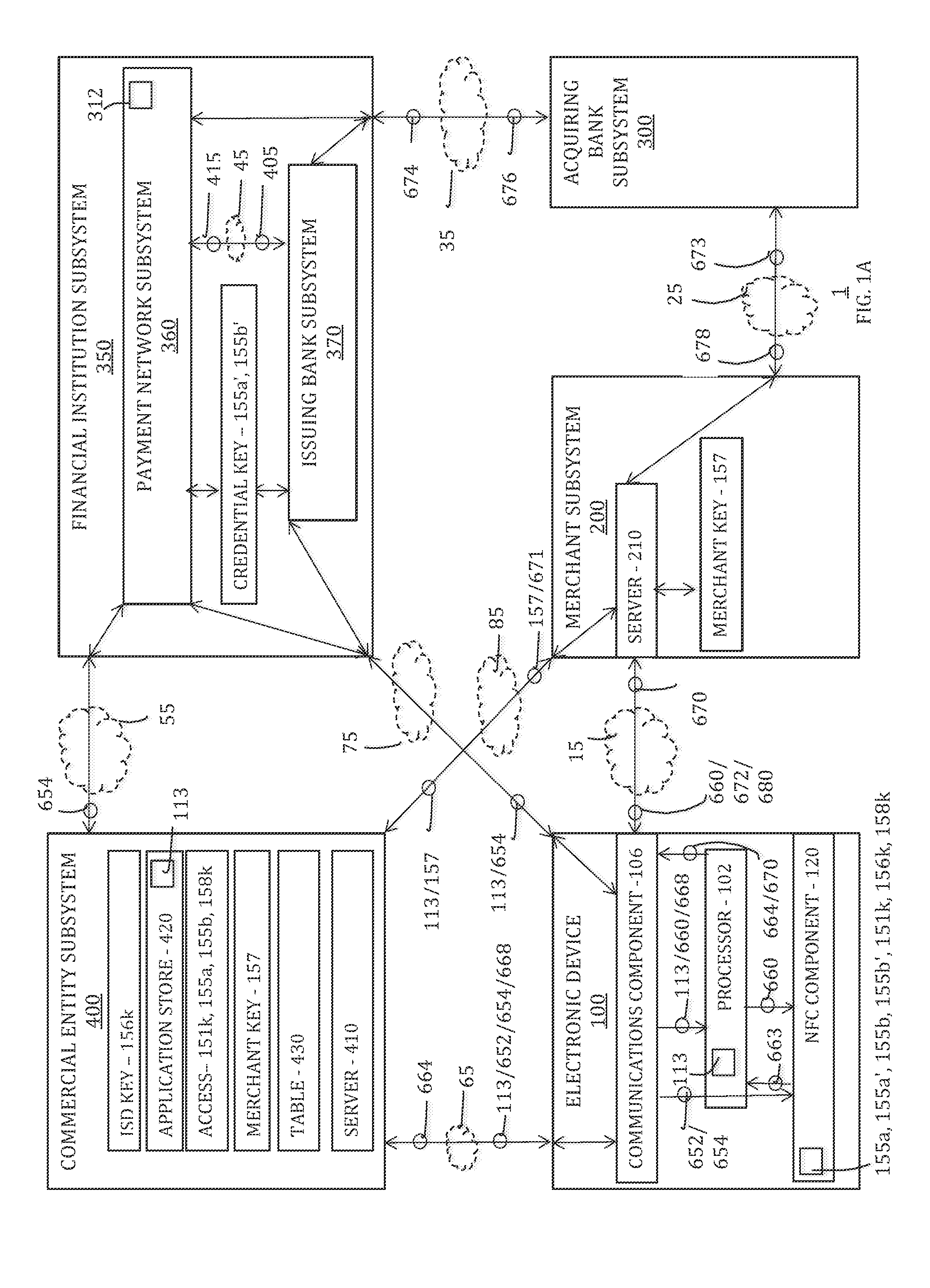

Multi-path communication of electronic device secure element data for online payments

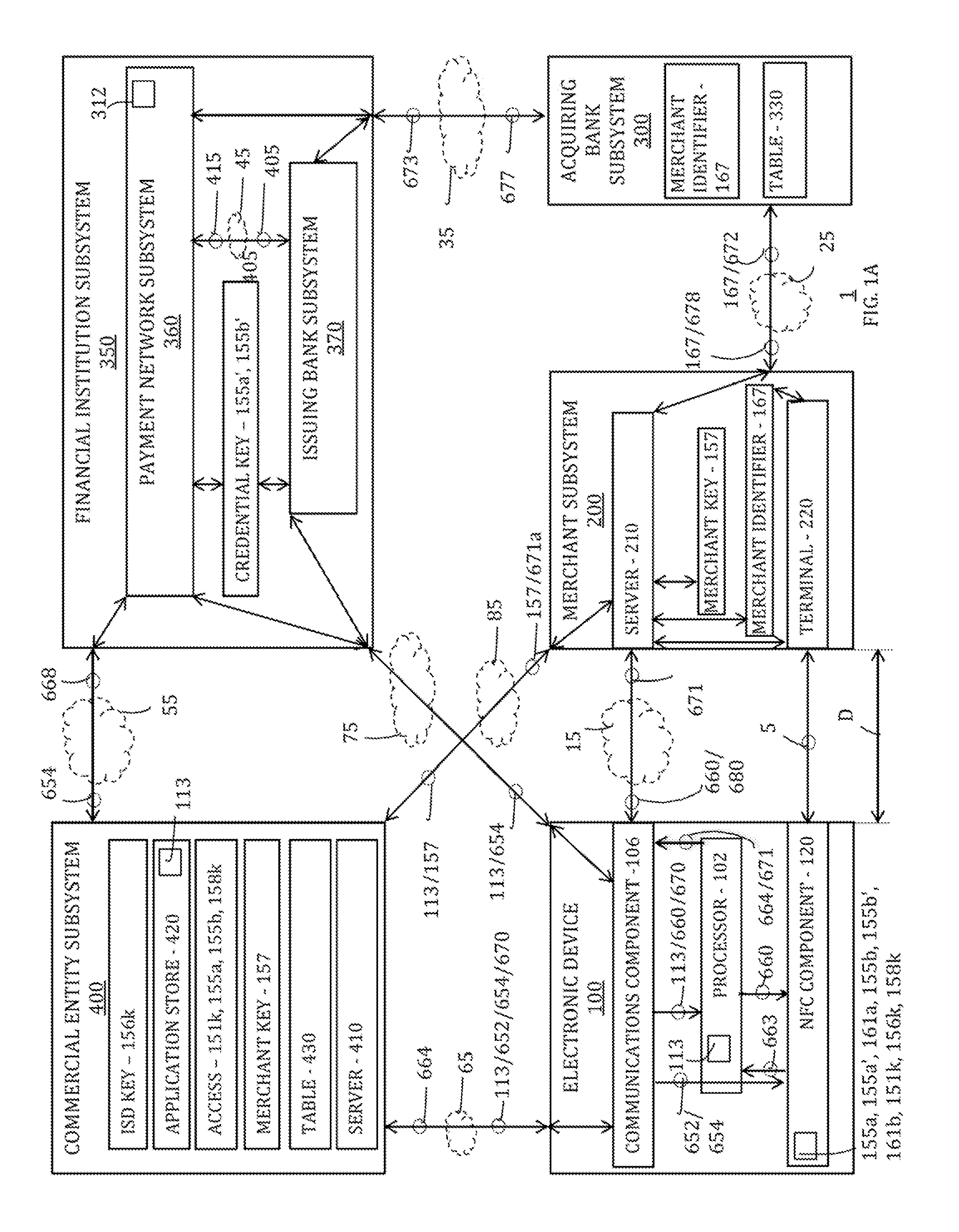

Systems, methods, and computer-readable media for communicating electronic device secure element data over multiple paths for online payments are provided. In one example embodiment, a method includes, inter alia, at a commercial entity subsystem, receiving, from an electronic device, device transaction data that includes credential data indicative of a payment credential on the electronic device for funding a transaction with a merchant subsystem, accessing a transaction identifier, deriving a transaction key based on transaction key data that includes the accessed transaction identifier, transmitting, to one of the merchant subsystem and the electronic device, merchant payment data that includes a first portion of the credential data and the accessed transaction identifier, and sharing, with a financial institution subsystem using the transaction key, commercial payment data that includes a second portion of the credential data that is different than the first portion of the credential data. Additional embodiments are also provided.

Owner:APPLE INC

Multi-path communication of electronic device secure element data for online payments

ActiveUS20170011395A1Improve risk assessmentKey distribution for secure communicationCryptography processingTransaction dataFinancial transaction

Systems, methods, and computer-readable media for communicating electronic device secure element data over multiple paths for online payments are provided. In one example embodiment, a method includes, inter alia, at a commercial entity subsystem, receiving, from an electronic device, device transaction data that includes credential data indicative of a payment credential on the electronic device for funding a transaction with a merchant subsystem, accessing a transaction identifier, deriving a transaction key based on transaction key data that includes the accessed transaction identifier, transmitting, to one of the merchant subsystem and the electronic device, merchant payment data that includes a first portion of the credential data and the accessed transaction identifier, and sharing, with a financial institution subsystem using the transaction key, commercial payment data that includes a second portion of the credential data that is different than the first portion of the credential data. Additional embodiments are also provided.

Owner:APPLE INC

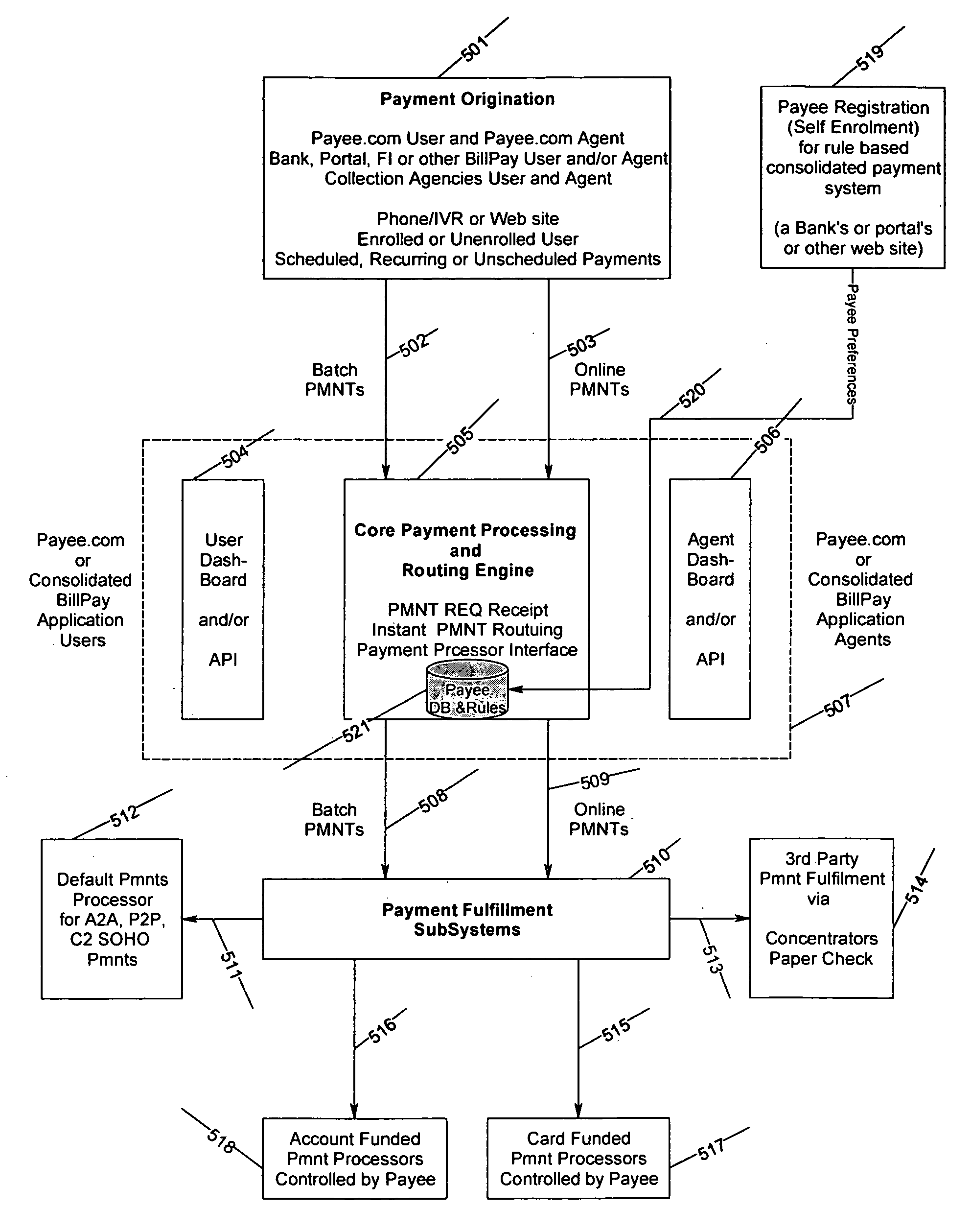

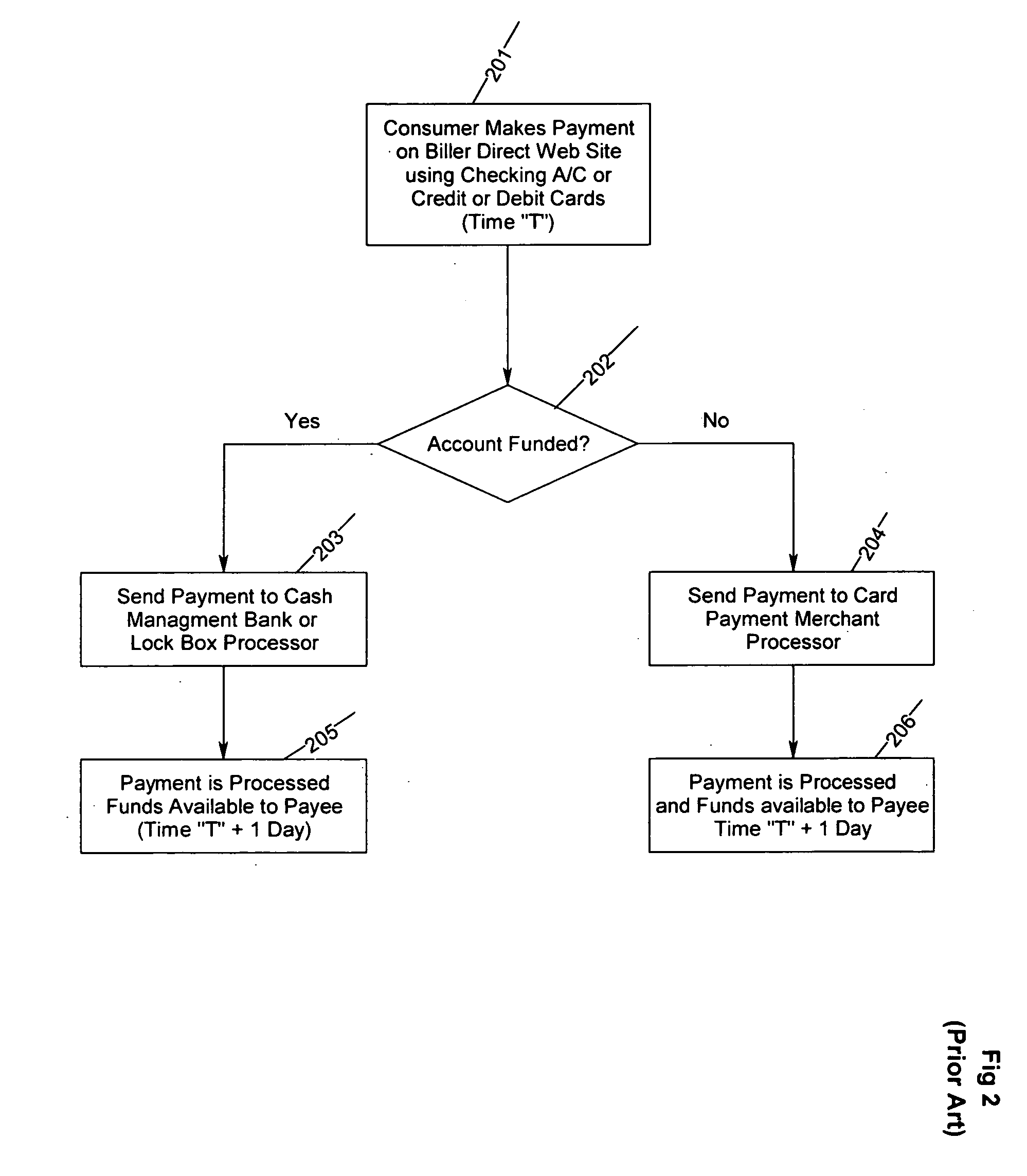

Electronic payment system for financial institutions and companies to receive online payments

InactiveUS20060206425A1Improve consumer experienceHigh speedFinanceProtocol authorisationPayment transactionPersonal account

The present invention provides an a electronic payment system for bank, financial institutions, portals and companies to receive payment from their customers for one or more payees. The electronic payment system allows payer (consumer or business) to use any funding method (bank account, credit / debit cards or any other business or personal account or method associated with one or more banks) accepted by the payee to initiate a payment and the payment transaction is routed to the appropriate payment processor based on payee's preferences. The electronic payment system also provides a instant payment delivery notification to the payer directly from the payee. The system also creates a unique payment tracking number which can be used by all parties associated with the transaction to track a payment's status and other attributes associated with the payment. The electronic payment system also provides a rule based payment management system for the payees to use for managing the processing and posting of the payments. The system also allows for payees to manage their payments received and post to various receivable systems based on rules defined. Additionally, the system allows payees to create rules for other aspects of payment processing. The system also allows for much simplified electronic bill delivery system which uses biller's existing infrastructure to create bill data for distribution to 3rd party consolidators.

Owner:PAYMENTUS CORP

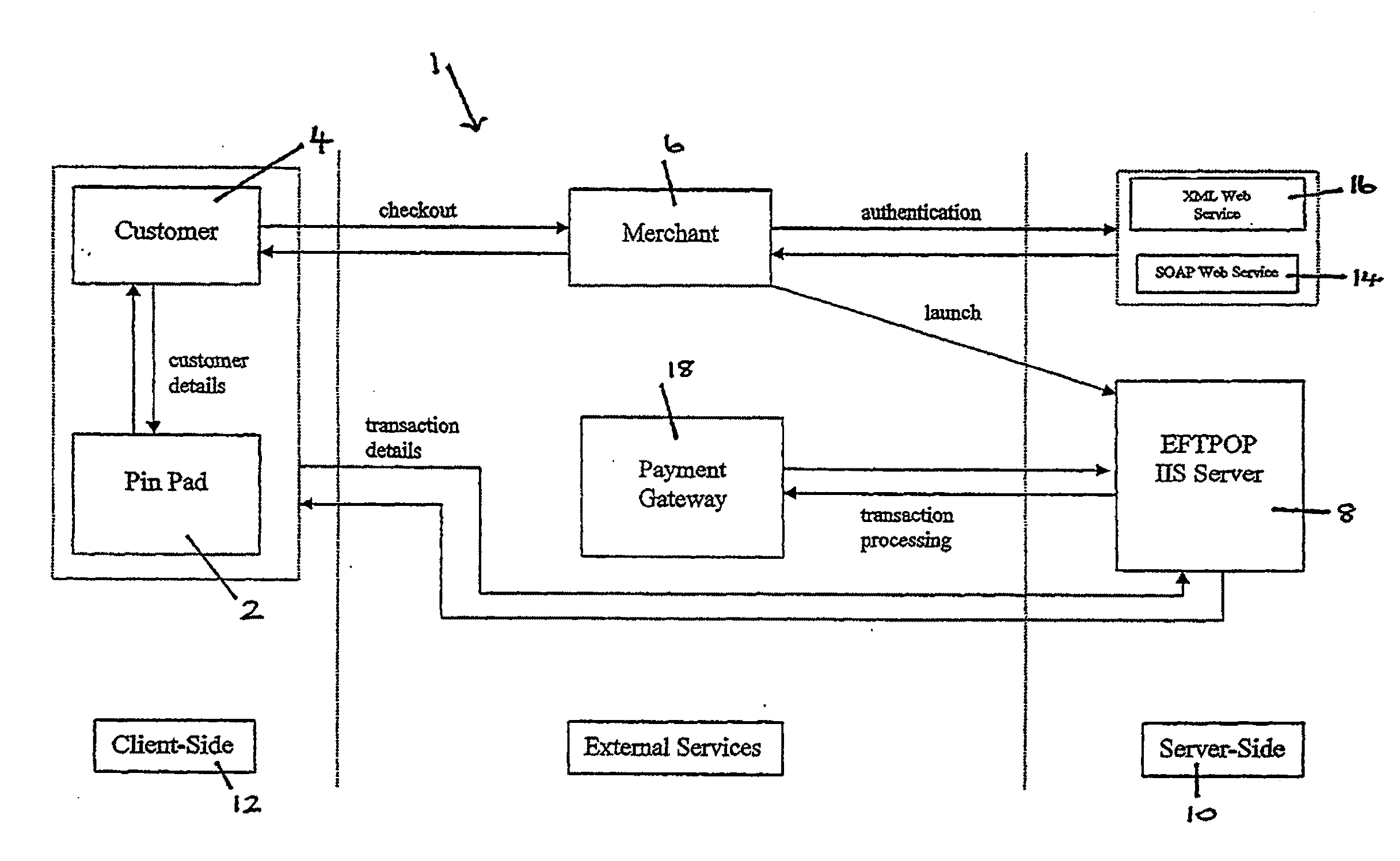

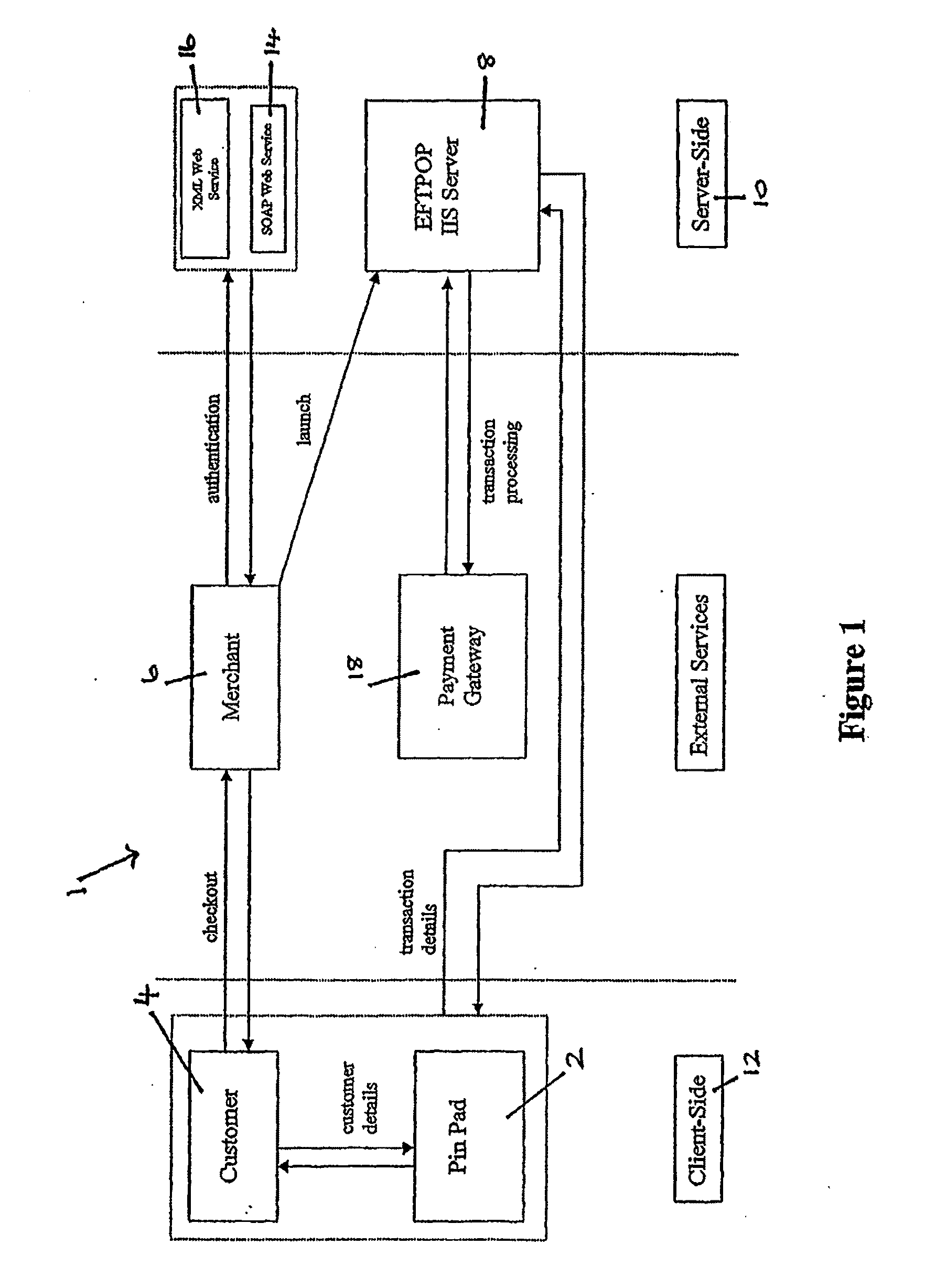

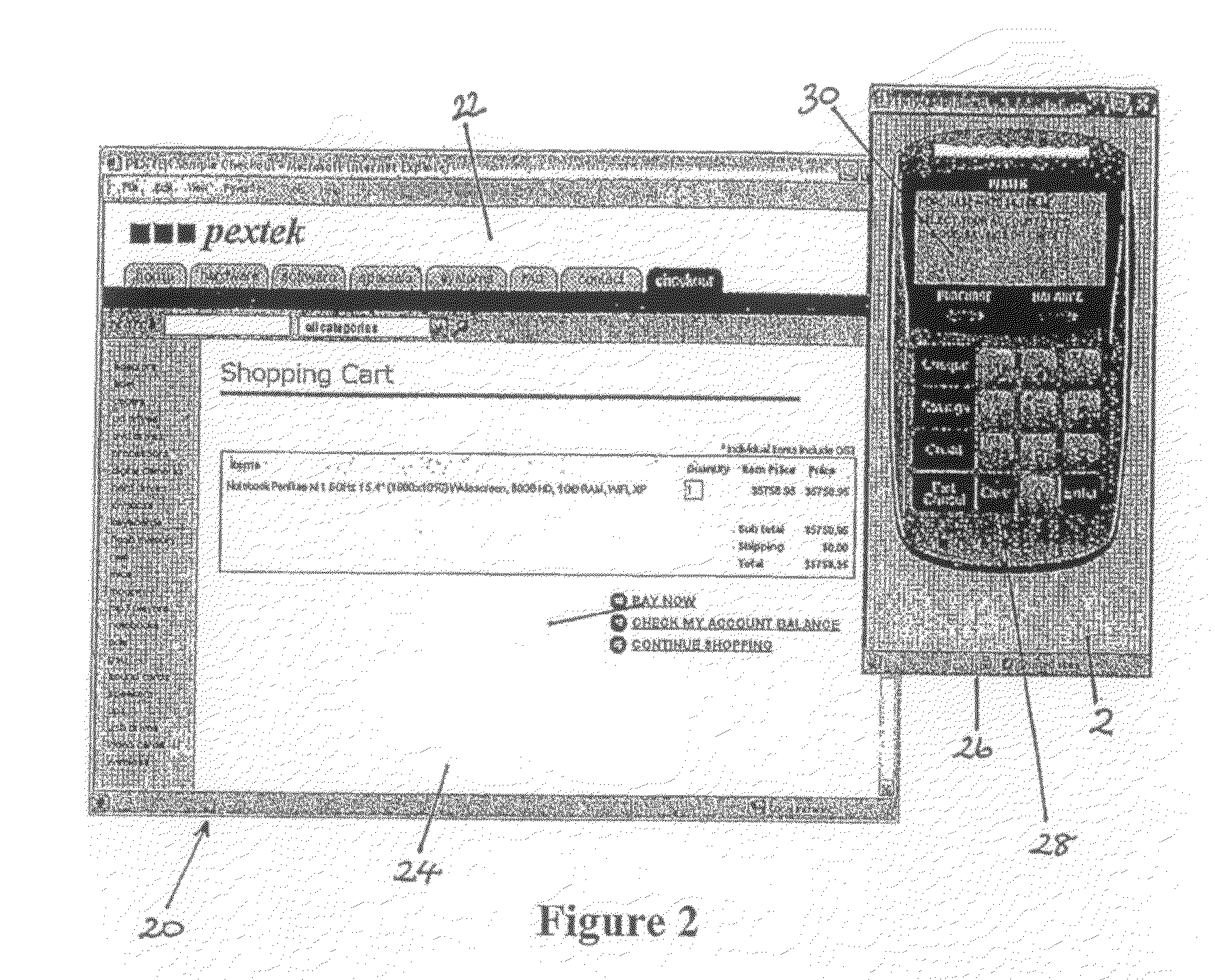

Online Payment System for Merchants

InactiveUS20090307133A1Improve vulnerabilityReduce the amount requiredFinancePayment circuitsBank accountInternet access

A payment system that utilises the Internet to gain access to an Internet banking system enabling a user to purchase merchandise bought through an online merchant or merchant who has Internet access in their store is disclosed. The payment system may also be utilised to provide a means for a user to retrieve and view balances and account transaction information for their bank accounts and to transfer funds between accounts. The system uses a “virtual pin-pad” which provides a web-based, stand-alone method of payment that is independent of banks and capable of performing real-time currency conversions.

Owner:EFTOL INT LTD

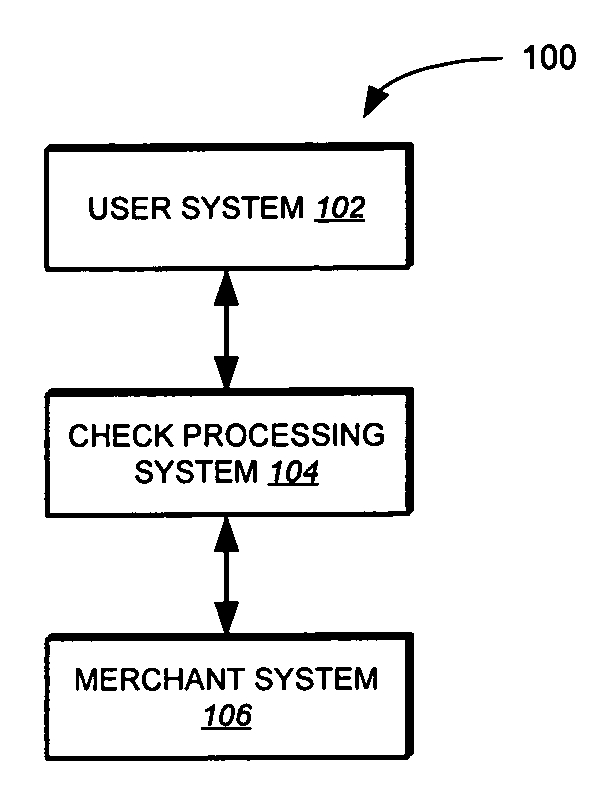

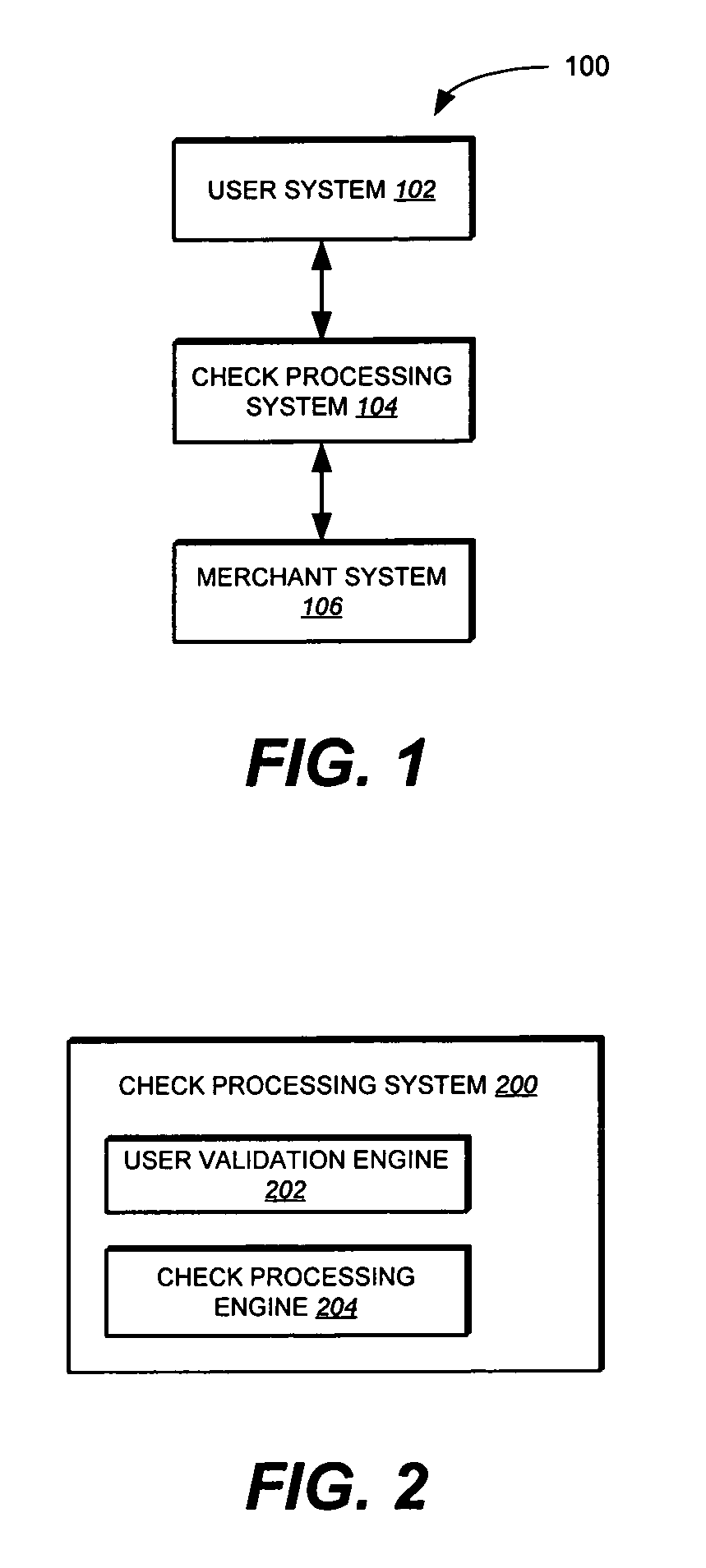

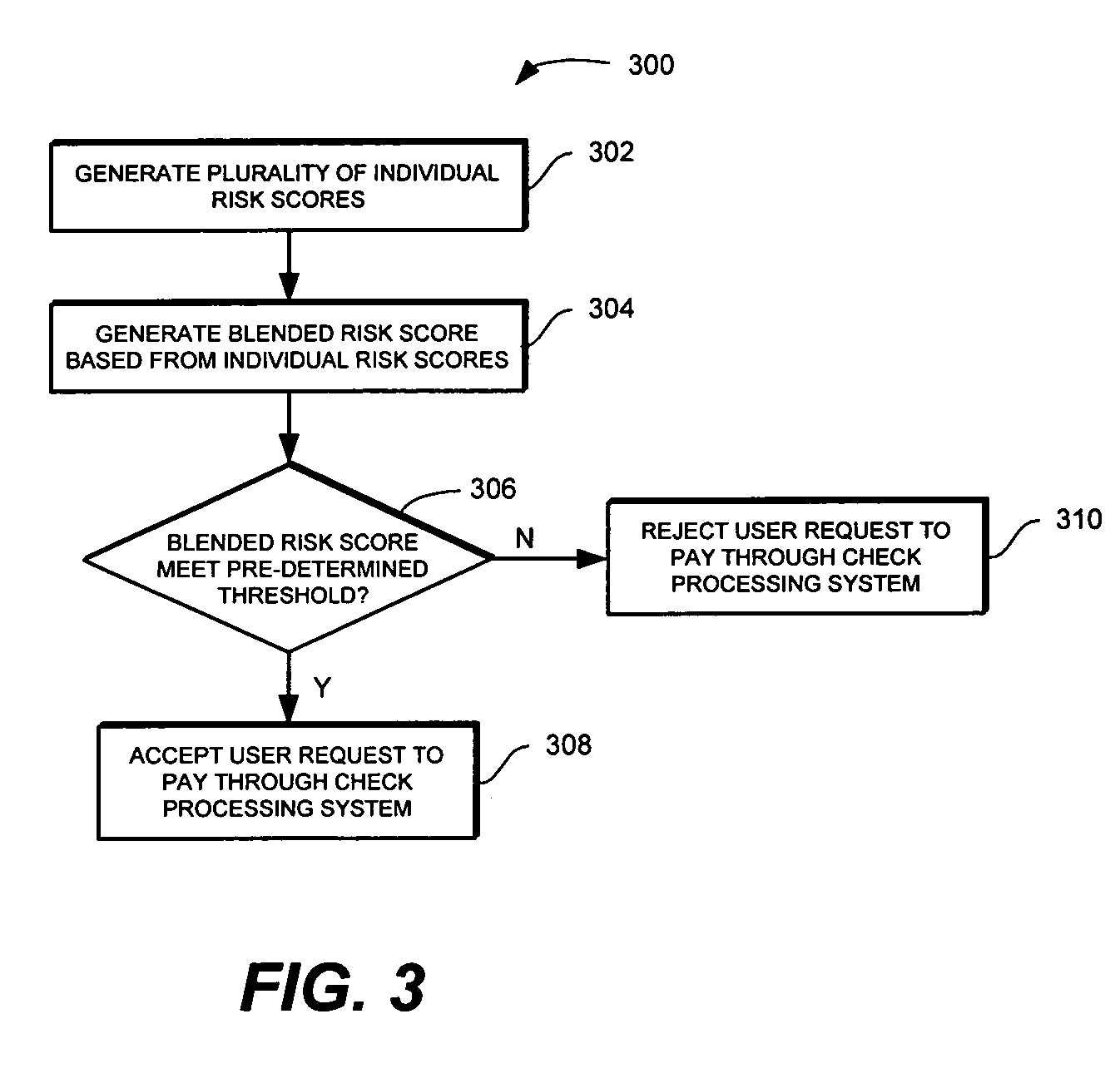

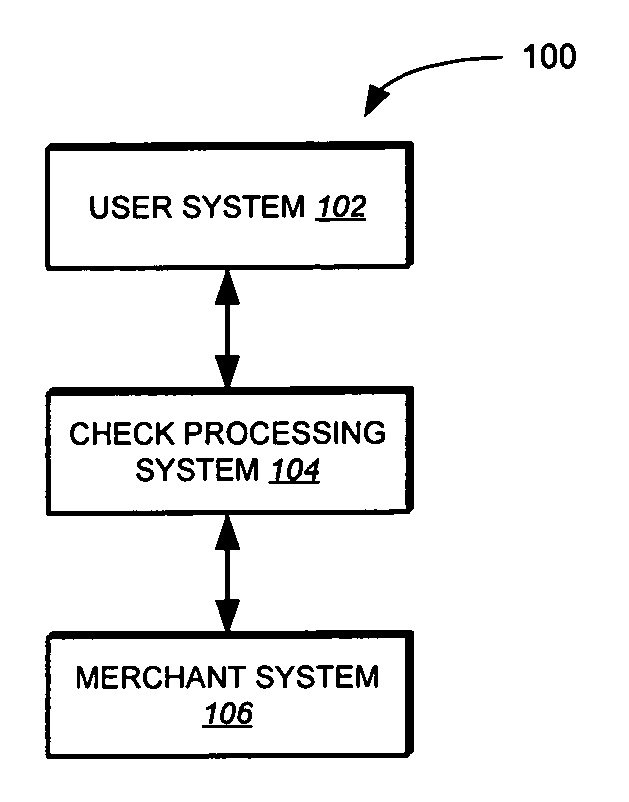

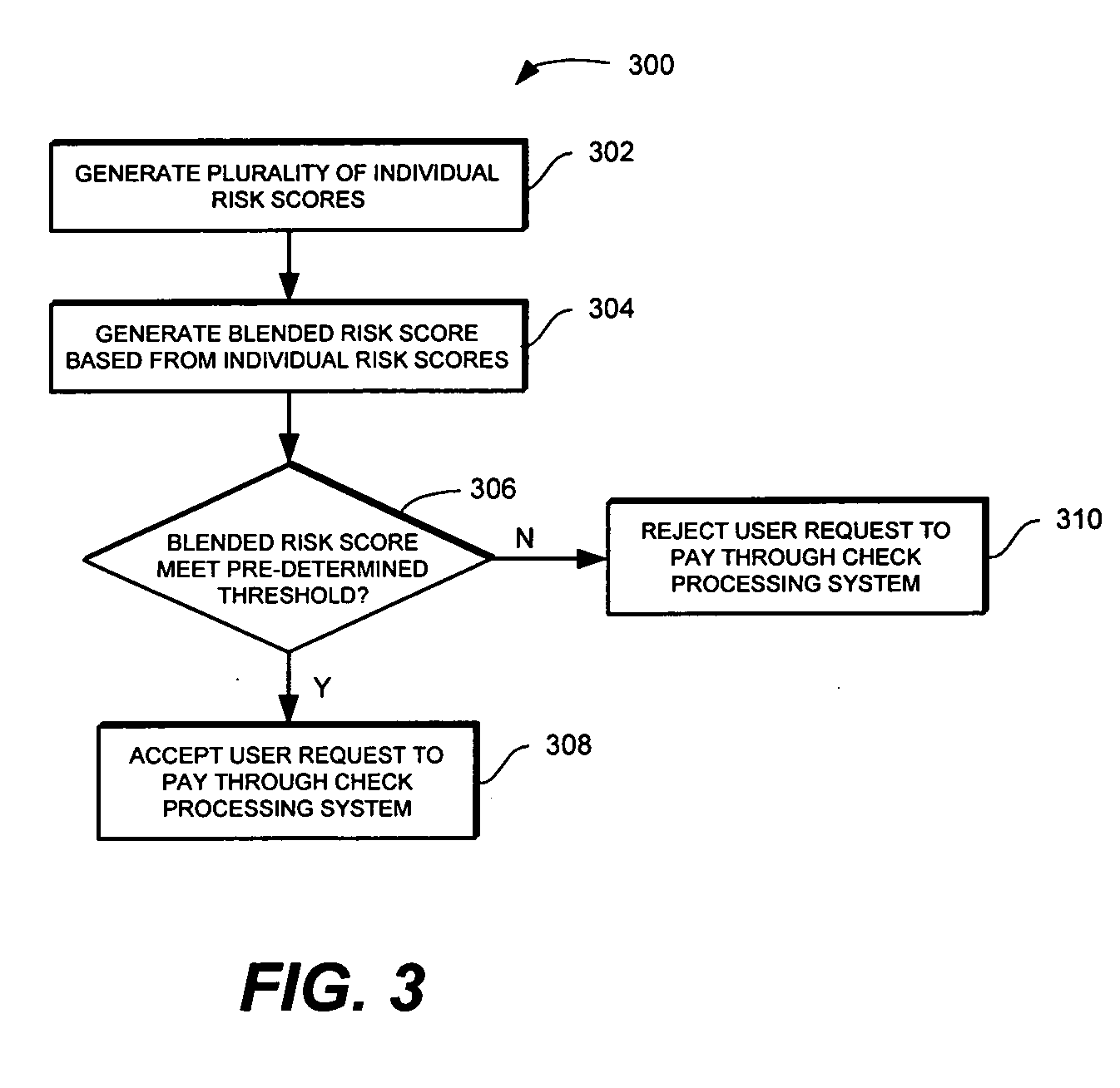

Method and apparatus for online check processing

Methods and apparatus for processing an online payment for an item. In one implementation, the method includes receiving information from a user corresponding to online payment for an item. The information from the user is received through a graphical user interface, and includes an authorization to pay for the item using an electronic check. The method further includes creating an electronic image of an authorized demand draft based on the authorization received from the user. The electronic image of the authorized demand draft is created directly from the information provided by the user through the graphical user interface.

Owner:STARRS ED

Method and apparatus for online check processing

Methods and apparatus for processing an online payment for an item. In one implementation, the method includes receiving information from a user corresponding to online payment for an item. The information from the user is received through a graphical user interface, and includes an authorization to pay for the item using an electronic check. The method further includes creating an electronic image of an authorized demand draft based on the authorization received from the user. The electronic image of the authorized demand draft is created directly from the information provided by the user through the graphical user interface.

Owner:STARRS ED

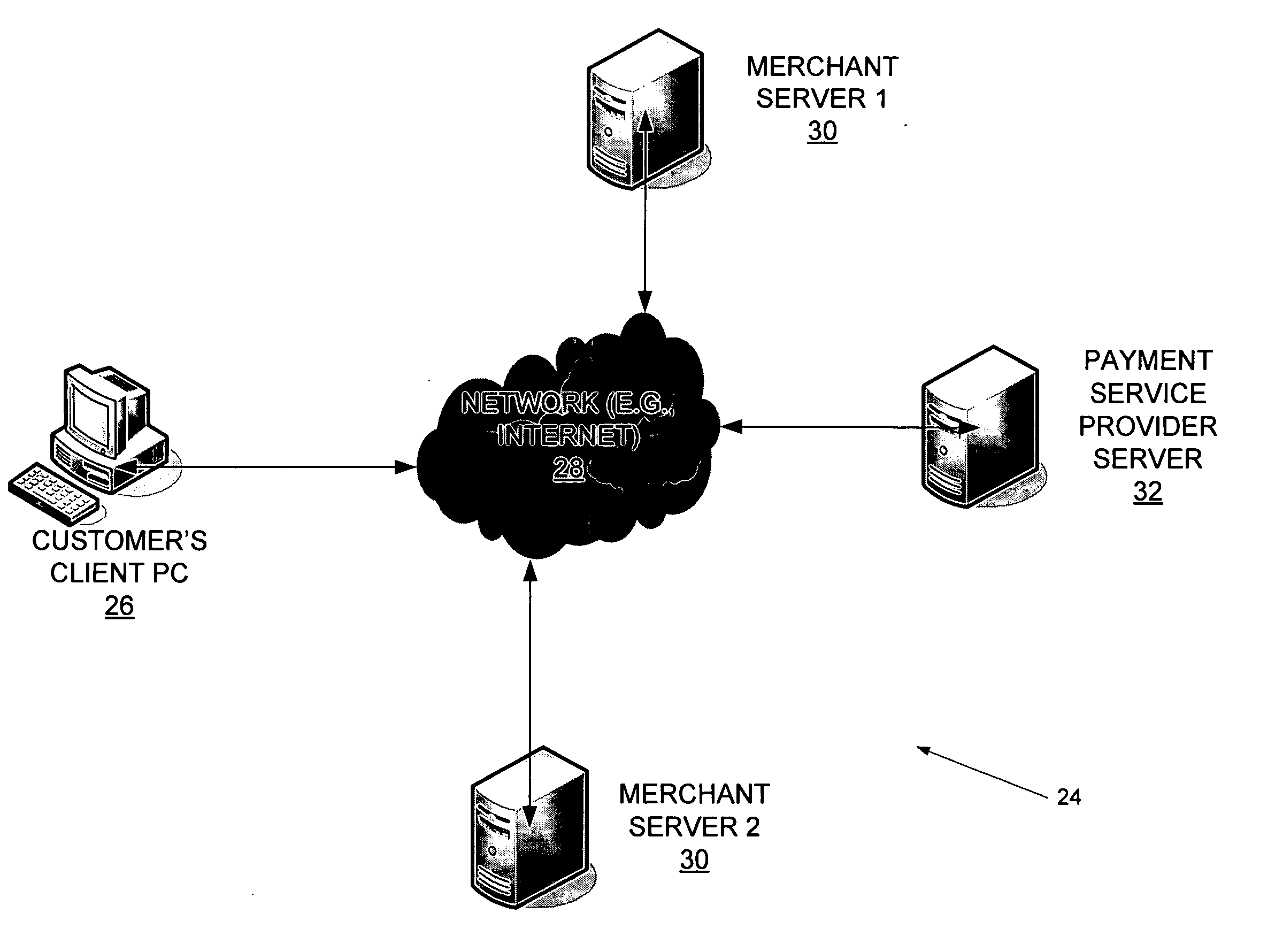

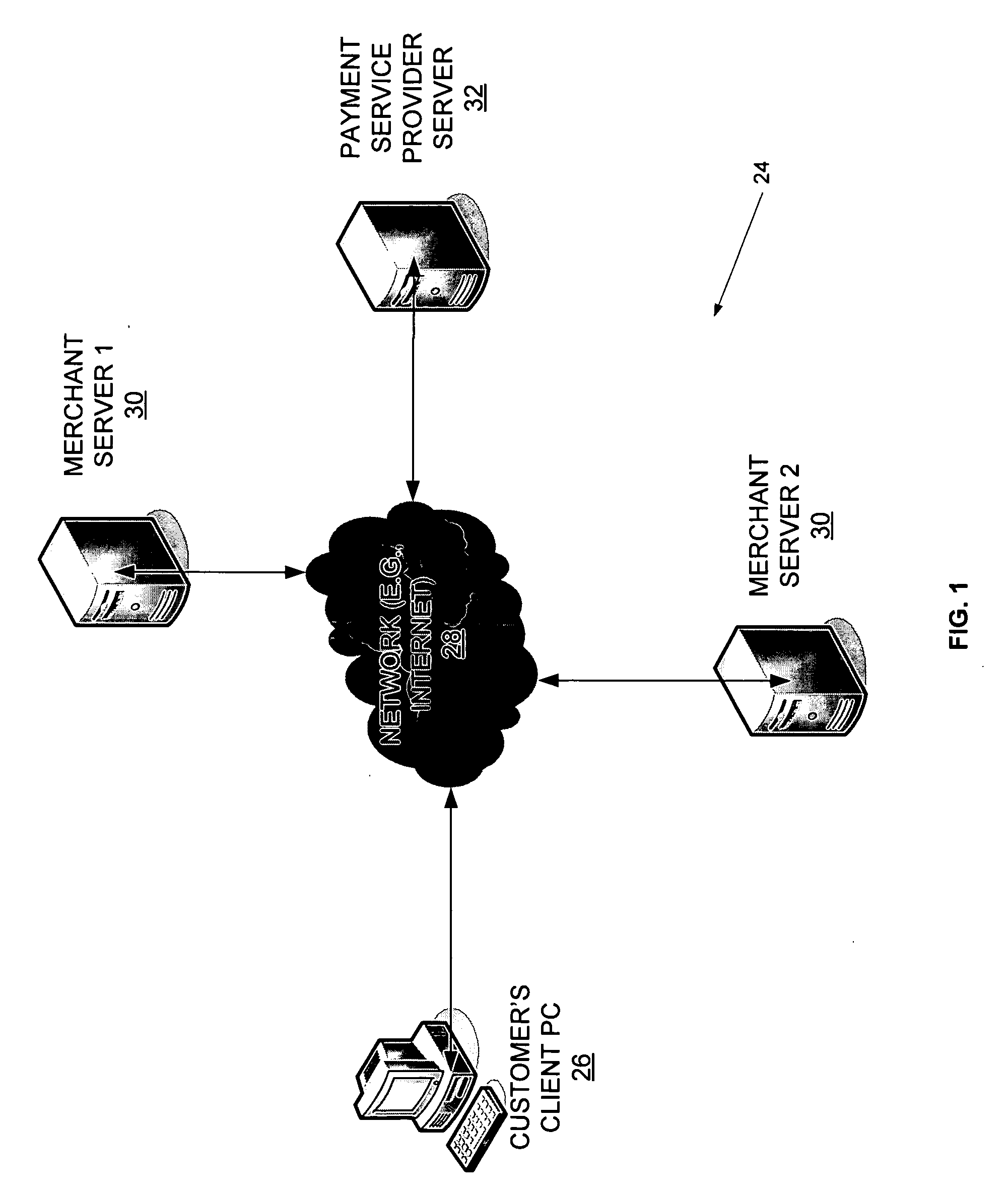

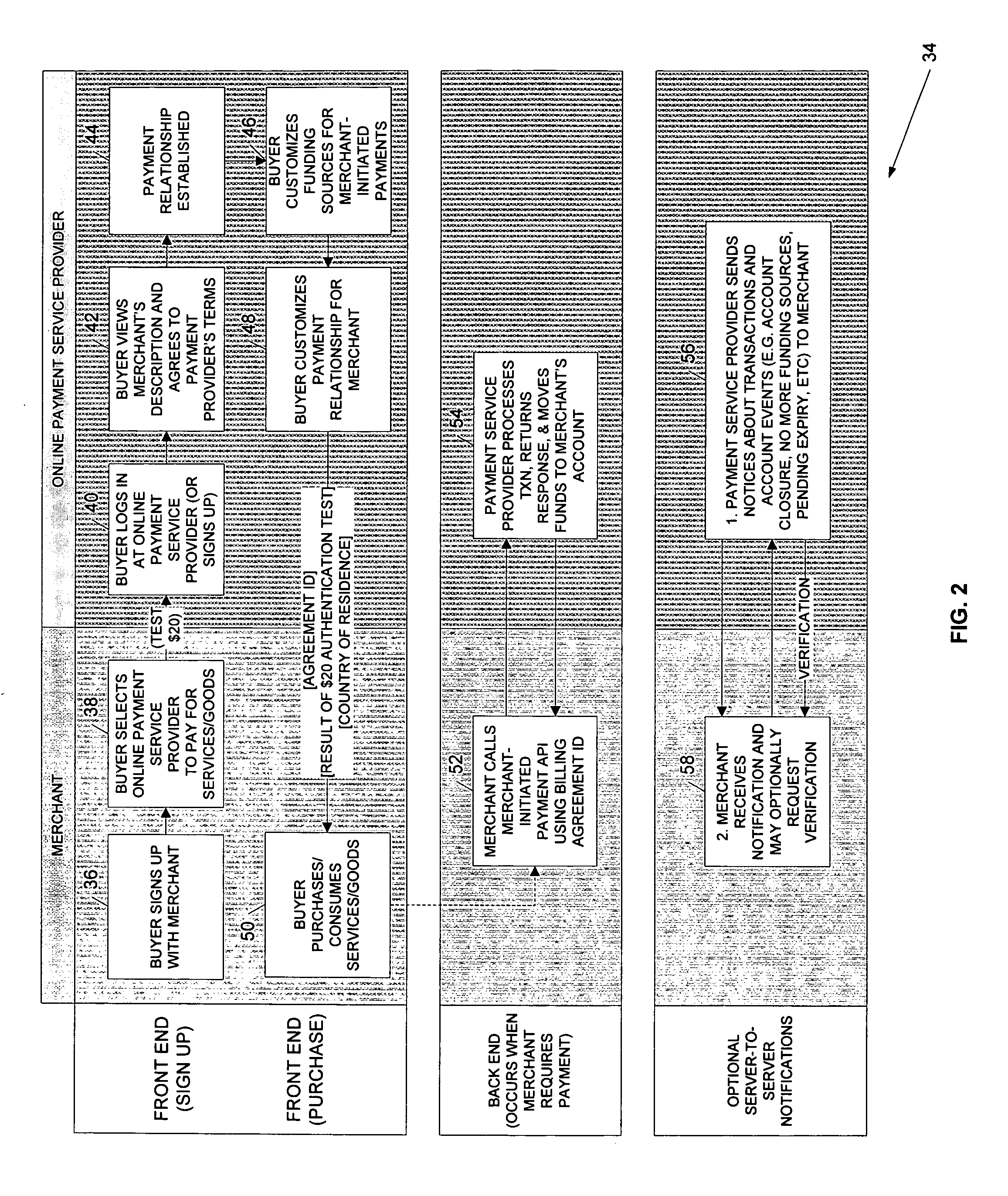

Method and system for facilitating merchant-initiated online payments

A method and system for facilitating merchant-initiated online payments are disclosed. According to one aspect of the present invention, a payment service provider's server receives a user's request, via a merchant's server, to establish a merchant-initiated payment relationship or agreement. Accordingly, the payment service provider presents the user with options to customize the terms of the merchant-initiated payment agreement. After the agreement has been established and the terms customized, the merchant server communicates a merchant-initiated payment request to the pavement service provider for a transaction entered into with the user. The payment service provider's server processes the payment request after verifying that processing the payment does not exceed the user-customized terms of the agreement.

Owner:PAYPAL INC

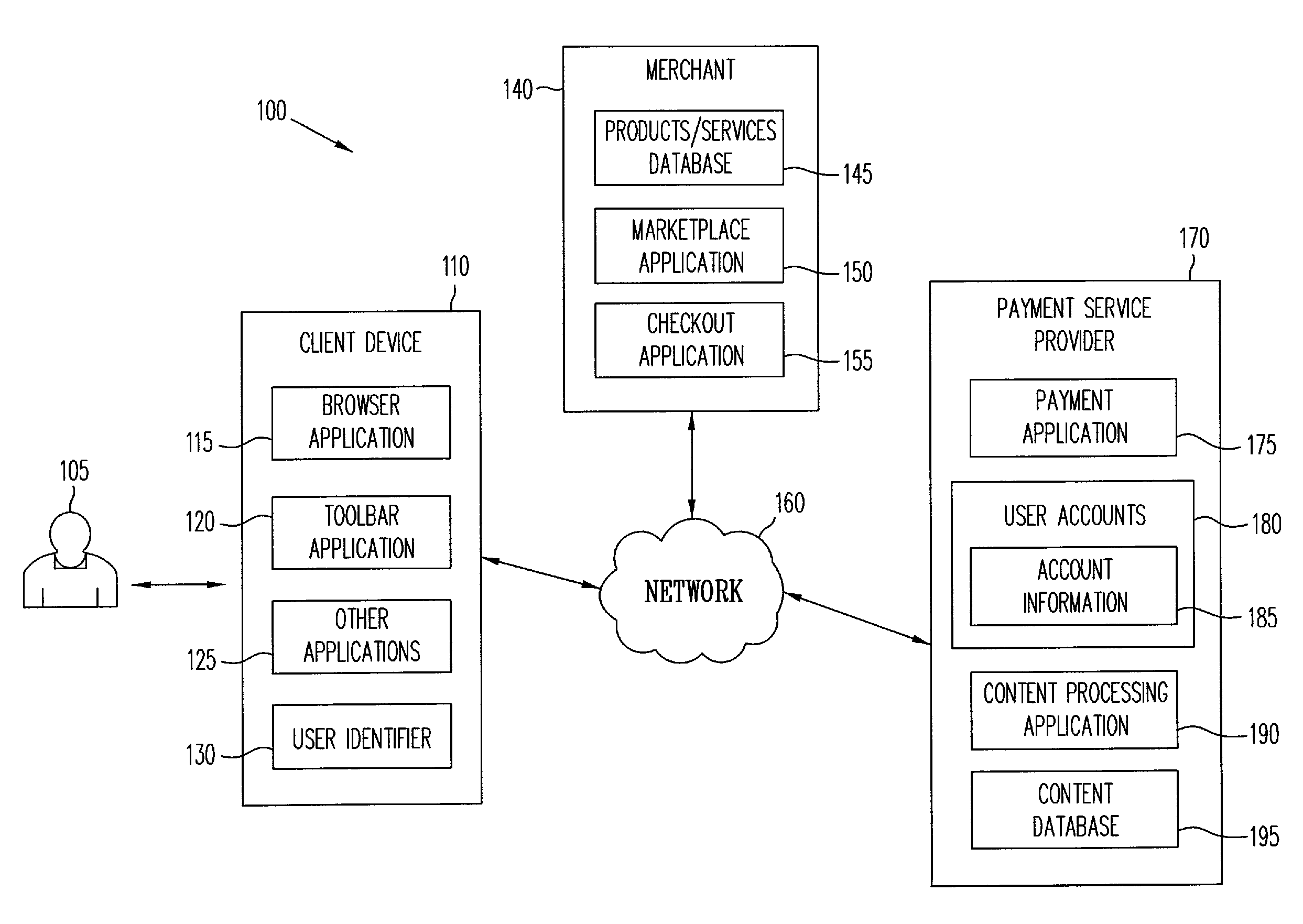

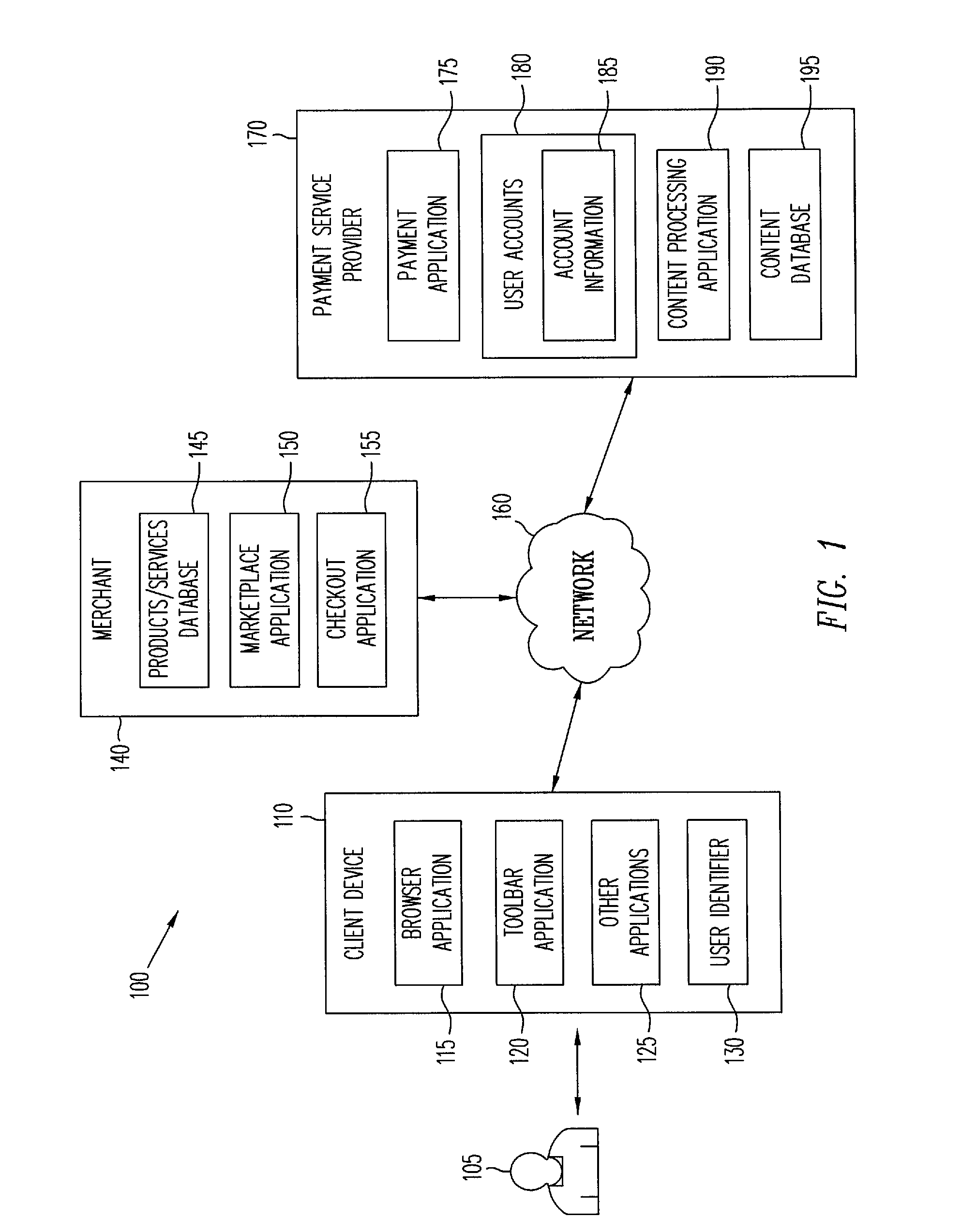

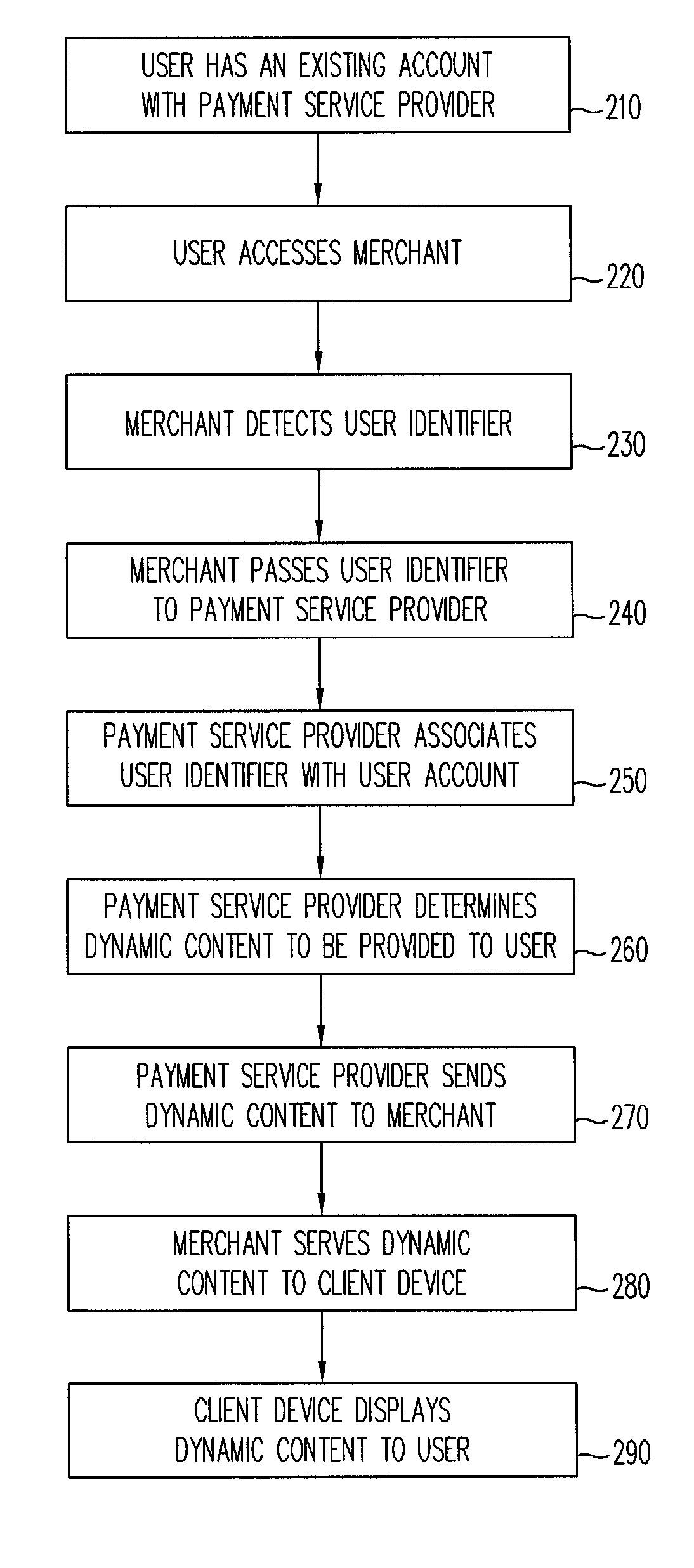

Dynamic content for online transactions

ActiveUS20070245022A1Promote disseminationFinanceMultiple digital computer combinationsClient-sideUser identifier

Various methods and systems are disclosed to provide dynamic content to users of online payment service providers without requiring users to log in or otherwise actively engage the payment service providers. In one example, a method of providing dynamic content includes providing a client device with access to an online marketplace over a network. The method also includes facilitating transmission of a user identifier stored by the client device to a payment service provider. The method further includes receiving dynamic content from the payment service provider in response to the user identifier. In addition, the method includes serving the dynamic content to the client device over the network.

Owner:PAYPAL INC

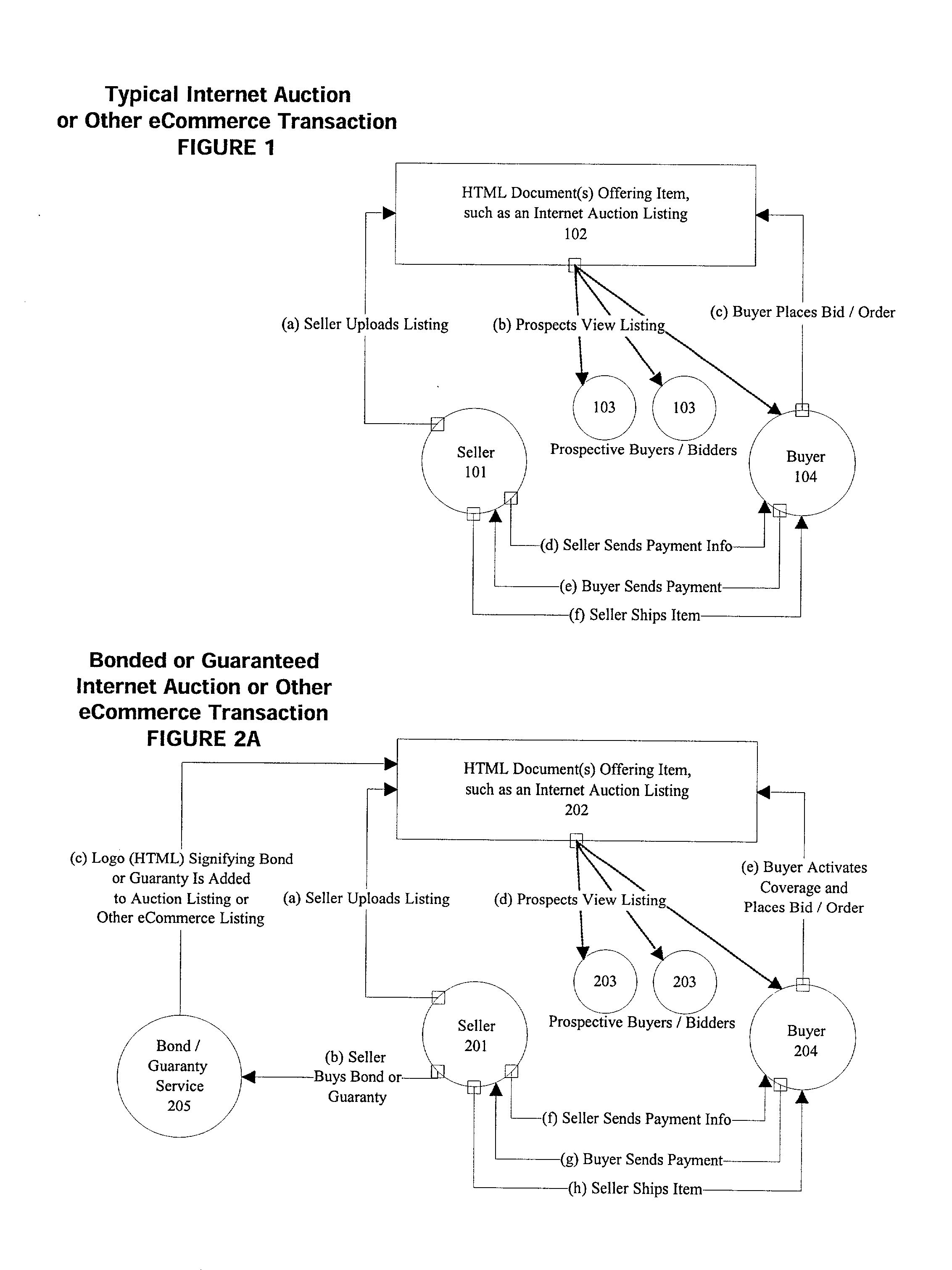

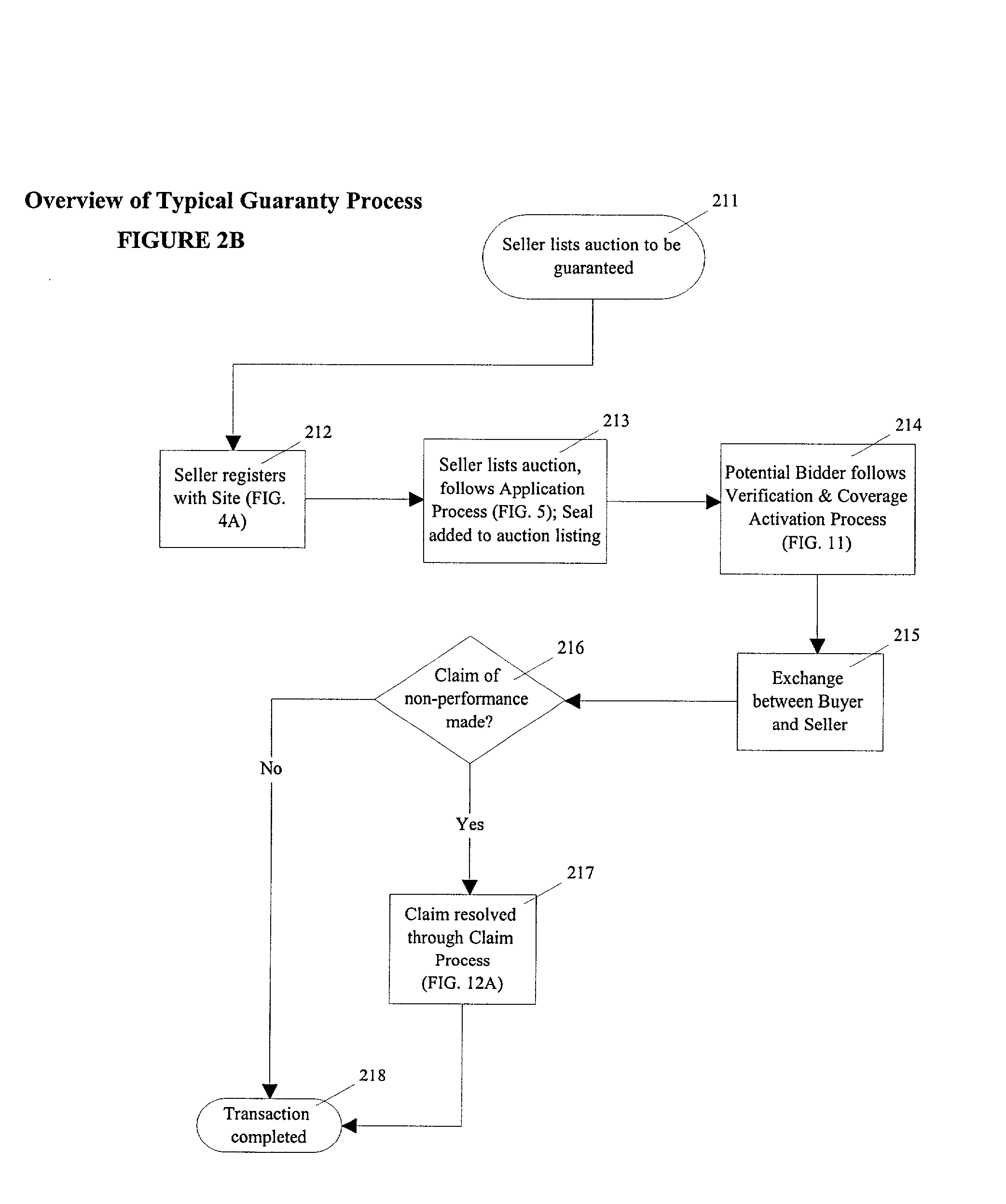

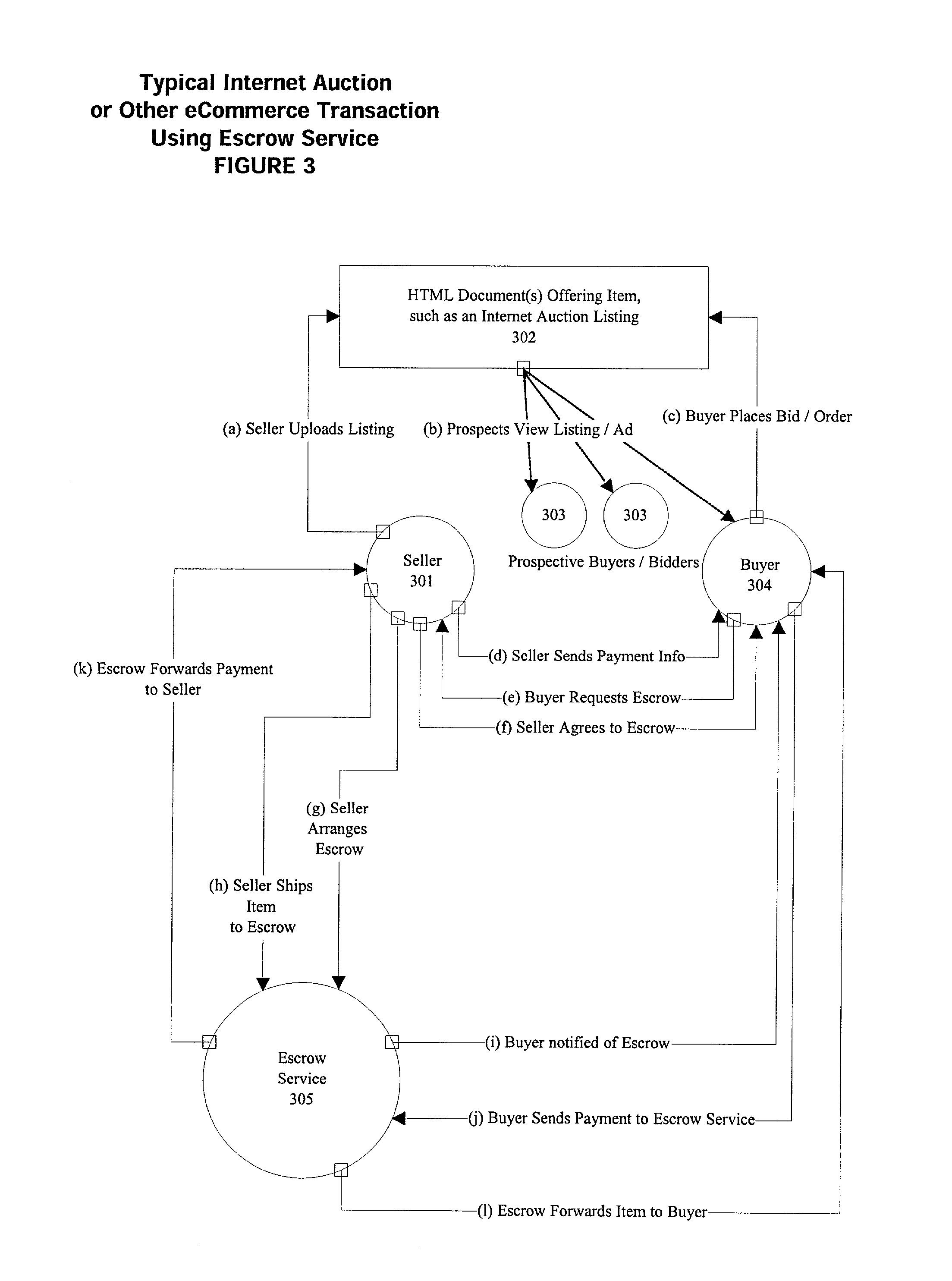

Electronic bond & guaranty process and business method

Disclosed is a method by which suretyship bonds and guaranties can be purchased and deployed over the Internet in real time, providing automatic application evaluation and policy binding. The principal's credit card information is used in a repeating cycle of pre-authorized charges so that the card account serves as effective collateral. A bond seal image, safeguarded against piracy, appears in Web pages indicating the existence of bond coverage. A dynamically updated gauge displays the margin of coverage available under the bond at any given moment. Means of integrating the information technology of auction site and surety company are also disclosed. The invention makes possible an unprecedented level of security in user-to-user auction environments and eliminates the need for online escrow services. Means of accepting bidder deposit accounts is also disclosed, enabling automatic, electronic payment the moment an Internet auction closes and eliminating the need for online payment services.

Owner:HARRISON JR SHELTON E

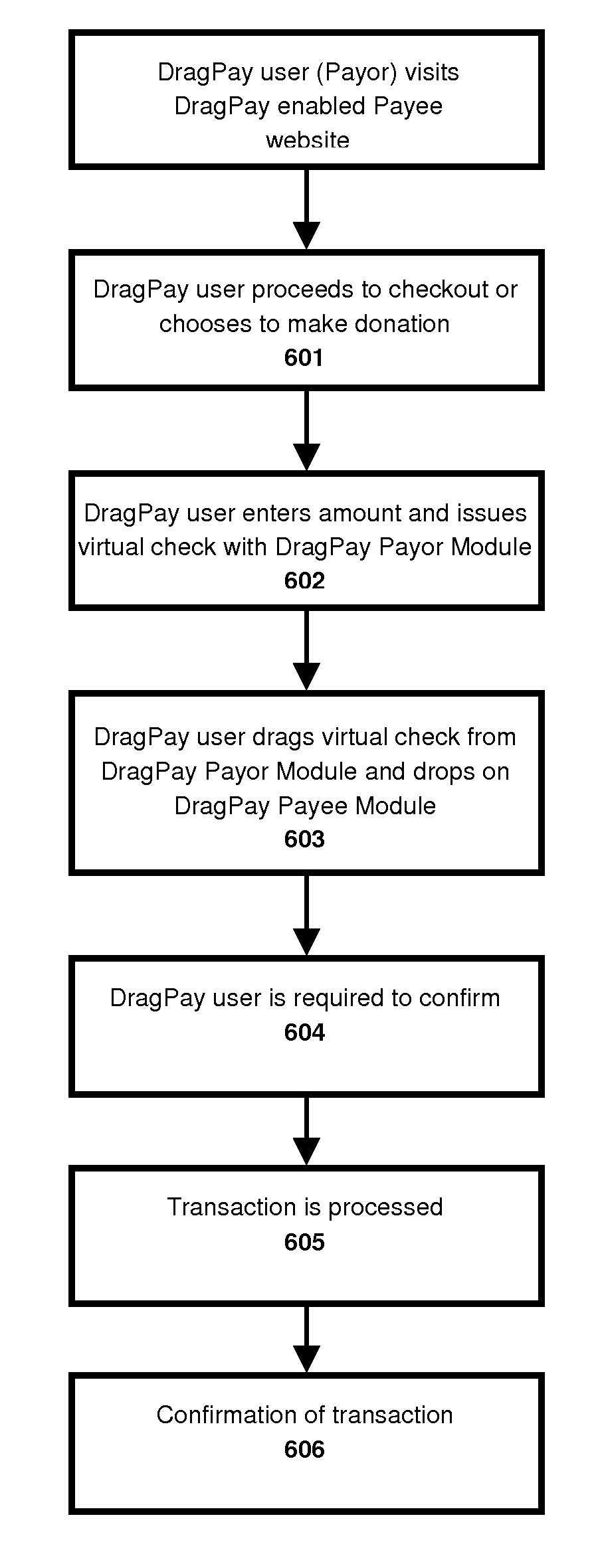

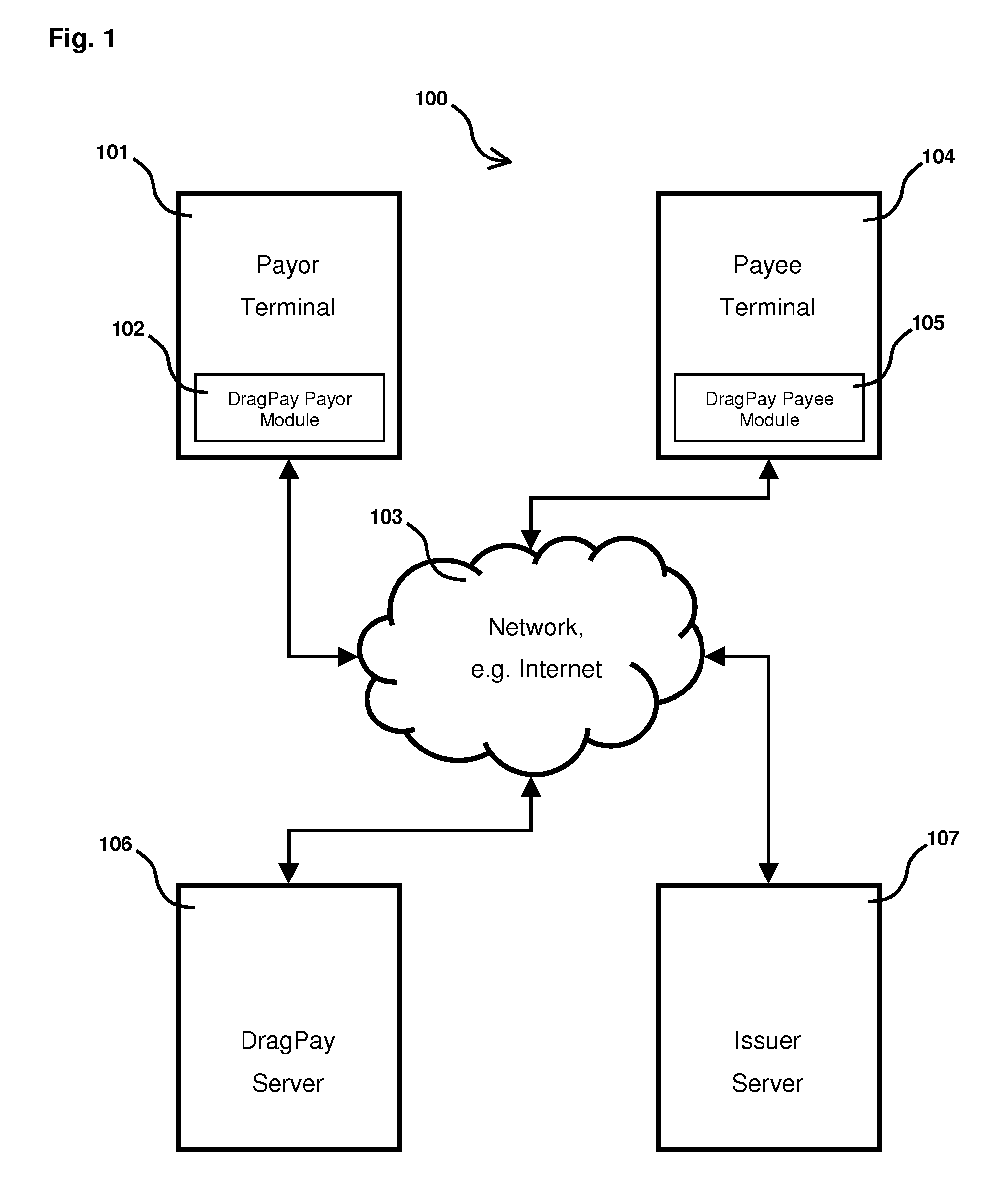

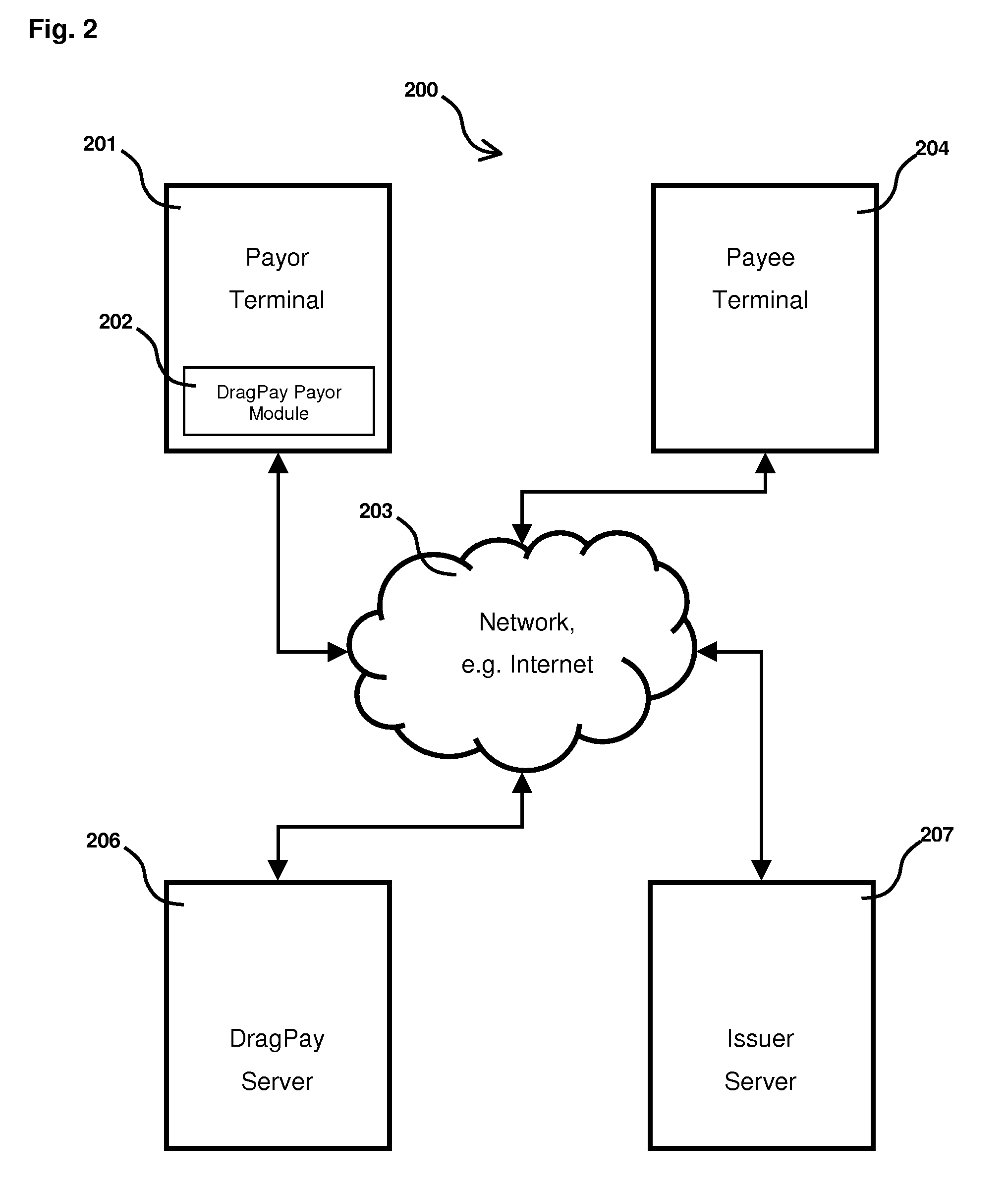

Methods and systems for making a payment and/or a donation via a network, such as the Internet, using a drag and drop user interface

InactiveUS20080301046A1Reduces authorization processing timeLow costFinancePayment architectureDrag and dropGraphics

The invention provides methods and systems that facilitate and expedite electronic transactions between a computer readable medium user (“Payor”), and a merchant or payee (“Payee”), including payment through the Internet. The invention allows the Payor to make a payment to a Payee of an exact desired amount using a drag and drop graphical user interface control, dragging from a graphical element displayed on the Payor terminal and dropping into a Payee's visual display on a website. The invention reduces the complexity and the time of the payment transaction, improving the user overall experience. The invention can be implemented for online commerce, for mobile payments, for small amount online payments, for online donations, or for payments using prepaid accounts. The invention can be implemented by an accounts issuer institution or by a funds and transactions managing entity.

Owner:MARTINEZ CHRISTIAN JOHN +1

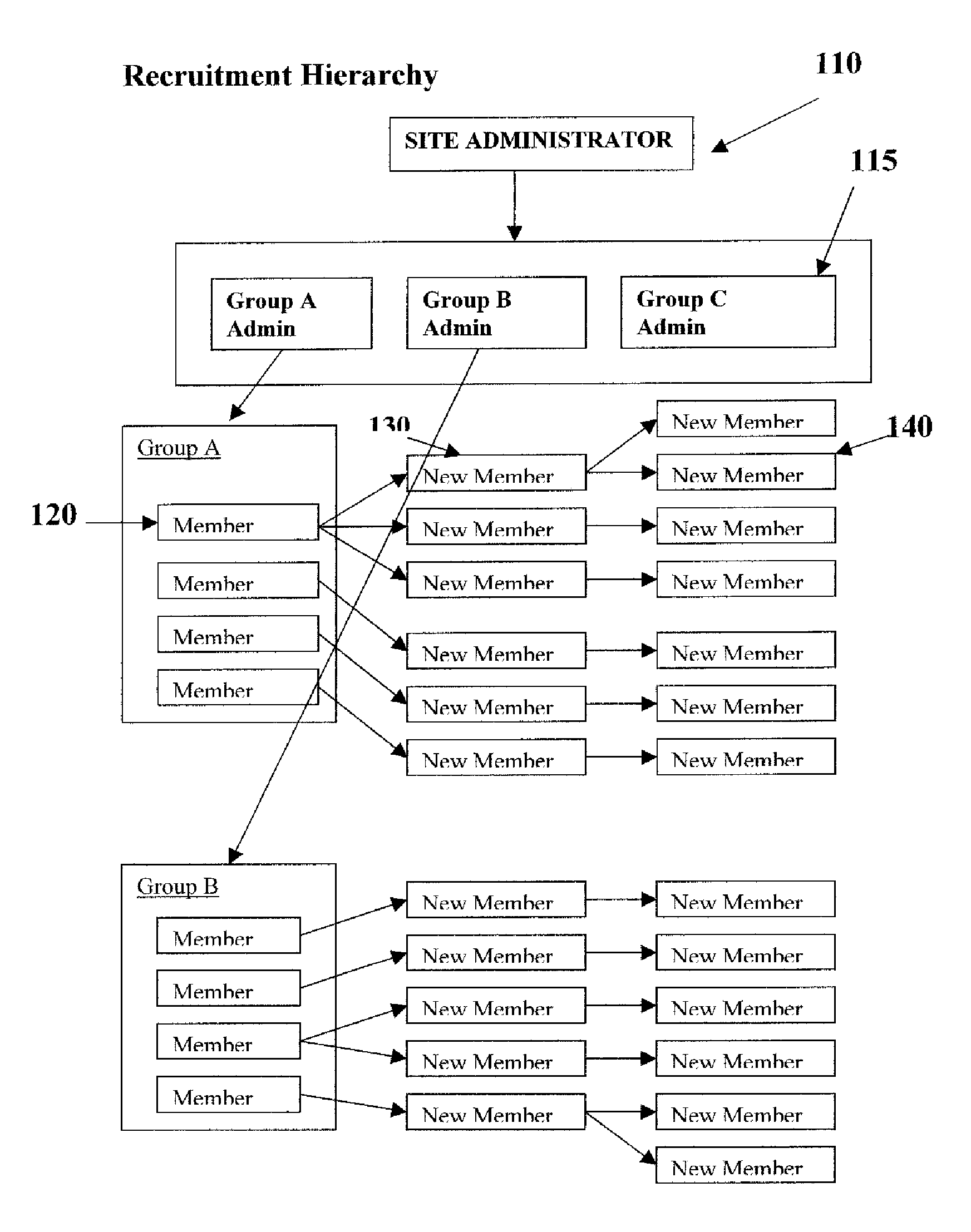

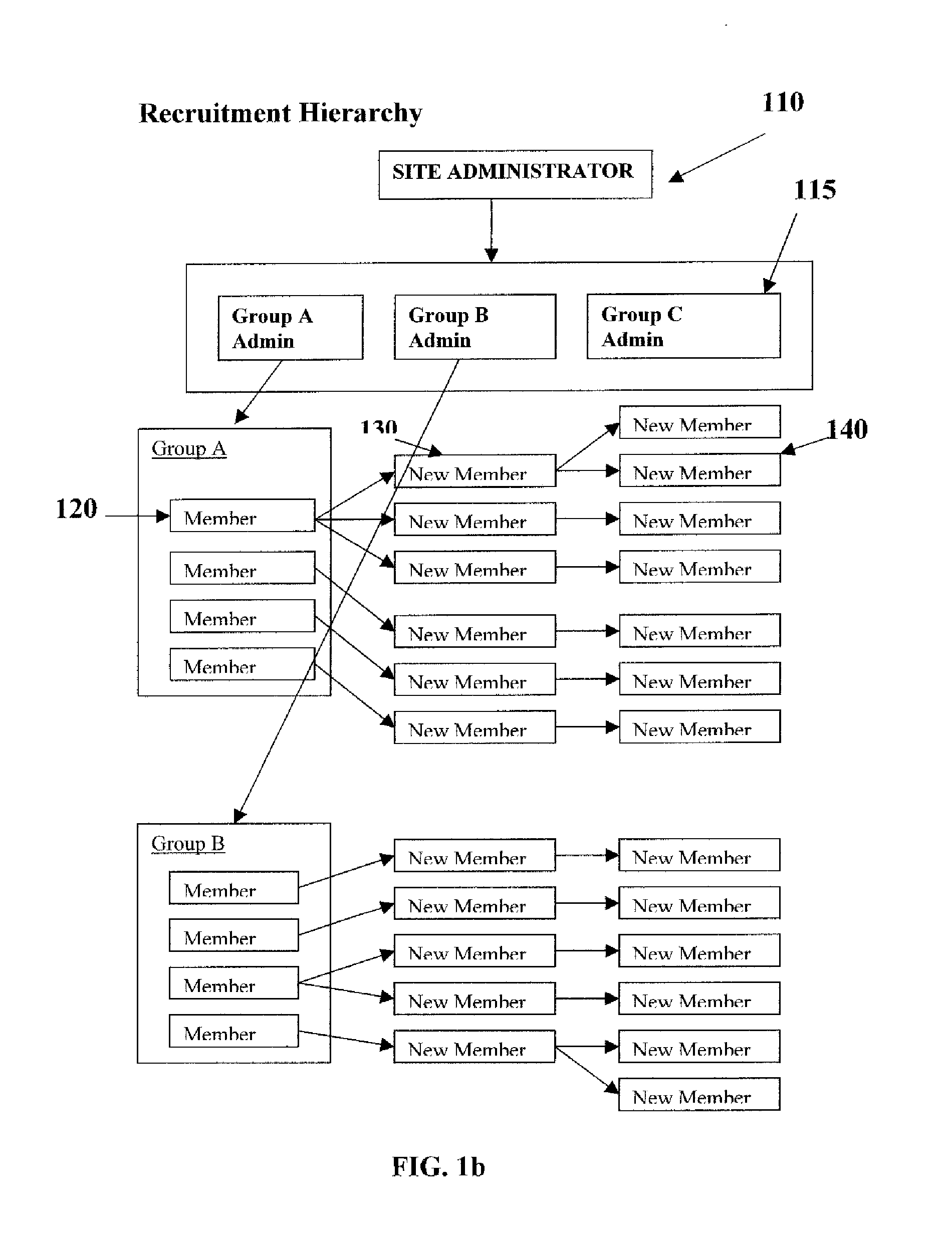

System and method for online group networks

InactiveUS20070220090A1Multiplex system selection arrangementsSpecial service provision for substationCredit cardLibrary science

A method and system is described for providing groups, organizations, associations and their chapters (groups) the ability to recruit members online, network and communicate with group members online, network and communicate with other groups online. A membership group is allowed to create a group online. This group is able to use technology to recruit other group members and to collect membership fees, convention and event fees, and donations via credit card and other online payment methods. A group is allowed to “link” with other groups. Members are able to create profiles and search the profile of members of their group as well as members of linked group. Members are given various online communication tools such as email, IM, Chat, Blog, and Forums to network and communicate with each other.

Owner:HALL ROHAN ROY

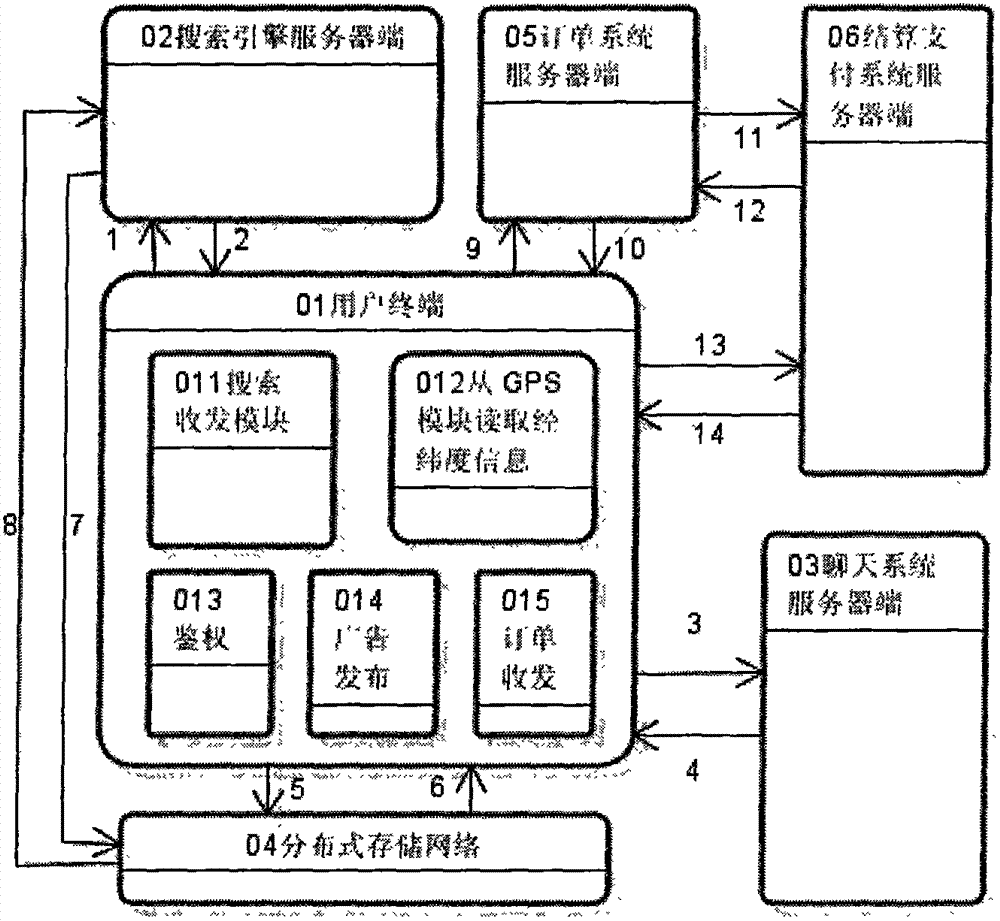

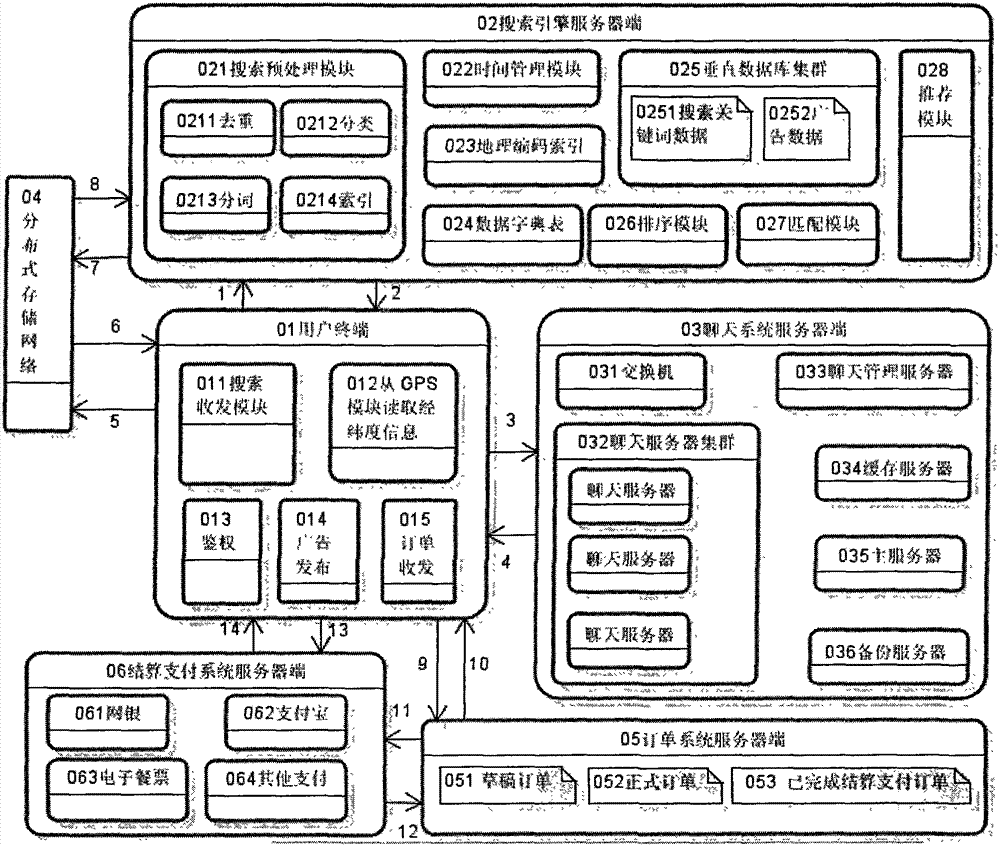

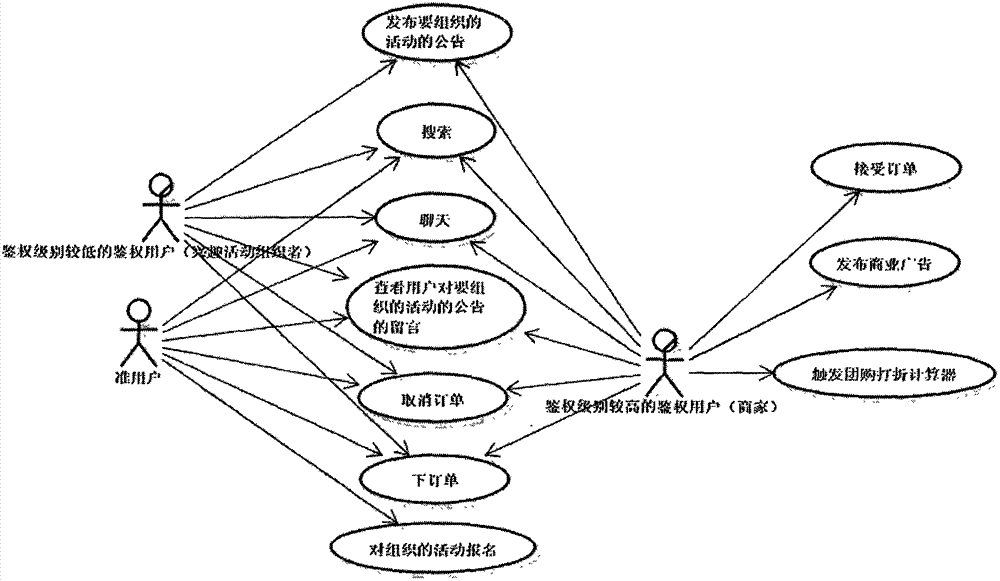

Distributed actual condition search engine based on geographic locations and trading system

InactiveCN102760174AStrong regionalStrong timelinessPayment architectureMarketingGeographic siteUser input

A distributed actual condition search engine based on geographic locations and a trading system comprise a user terminal, a search engine system server end, a chat system server end, an order system server end, a payment settlement system server end and a distributed storage network. When a user inputs business information for ordering at the user terminal, the information is sent to the search engine system server end to search information such as user ID, IP address, port number, commodity content and advertisement of merchants who are closes to the user at the geographic location and return the user terminal, the user is connected with a chat system server end according to the information to chat with the merchants, the user can order and select online payment or offline payment if the user is satisfied, if the online payment is selected, the order can be issued to the payment settlement system server end to conduct settlement payment, and when the user inputs the business information for ordering at the user terminal, the information is sent to the distributed storage network for backup and storage simultaneously.

Owner:吴建辉

Initiation of online payments using an electronic device identifier

Systems, methods, and computer-readable media for conducting payments are provided. In one example embodiment, a commercial entity system, in communication with a merchant subsystem and a payment electronic device, includes at least one processor component, at least one memory component, and at least one communications component, wherein the commercial entity system is configured to receive transaction request data from the merchant subsystem, wherein the transaction request data includes a payment device identifier of the payment electronic device and transaction information related to a transaction, transmit payment request data to the payment electronic device, wherein the payment request data includes at least a portion of the transaction information of the received transaction request data, receive payment card data from the payment electronic device based on the transmitted payment request data, and transmit at least a portion of the received payment card data to the merchant subsystem. Additional embodiments are also provided.

Owner:APPLE INC

Method and apparatus for facilitating online payment transactions in a network-based transaction facility

InactiveUS20060116957A1Facilitating online payment transactionFacilitate online payment transactionFinanceBuying/selling/leasing transactionsRisk levelPayment transaction

A method and a system to transfer payment to a seller associated with a transaction facility are described. In one aspect, a risk level involved in a payment transaction using a scoring algorithm is evaluated based on seller-specific criteria; and a payment is processed based on the evaluation.

Owner:PAYPAL INC

Online payments using a secure element of an electronic device

InactiveUS20150095238A1Facilitate payment transactionProtocol authorisationBusiness entityElectronic equipment

Systems, methods, and computer-readable media for securely conducting online payments with a secure element of an electronic device are provided. In one example embodiment, a method includes, inter alia, at an electronic device, generating first data that includes payment card data, generating second data by encrypting the first data and merchant information with a first key, transmitting to a commercial entity subsystem the generated second data, receiving third data that includes the first data encrypted with a second key that is associated with the merchant information, and transmitting the received third data to a merchant subsystem that is associated with the merchant information, where the first key is not accessible to the merchant subsystem, and where the second key is not accessible to the electronic device. Additional embodiments are also provided.

Owner:APPLE INC

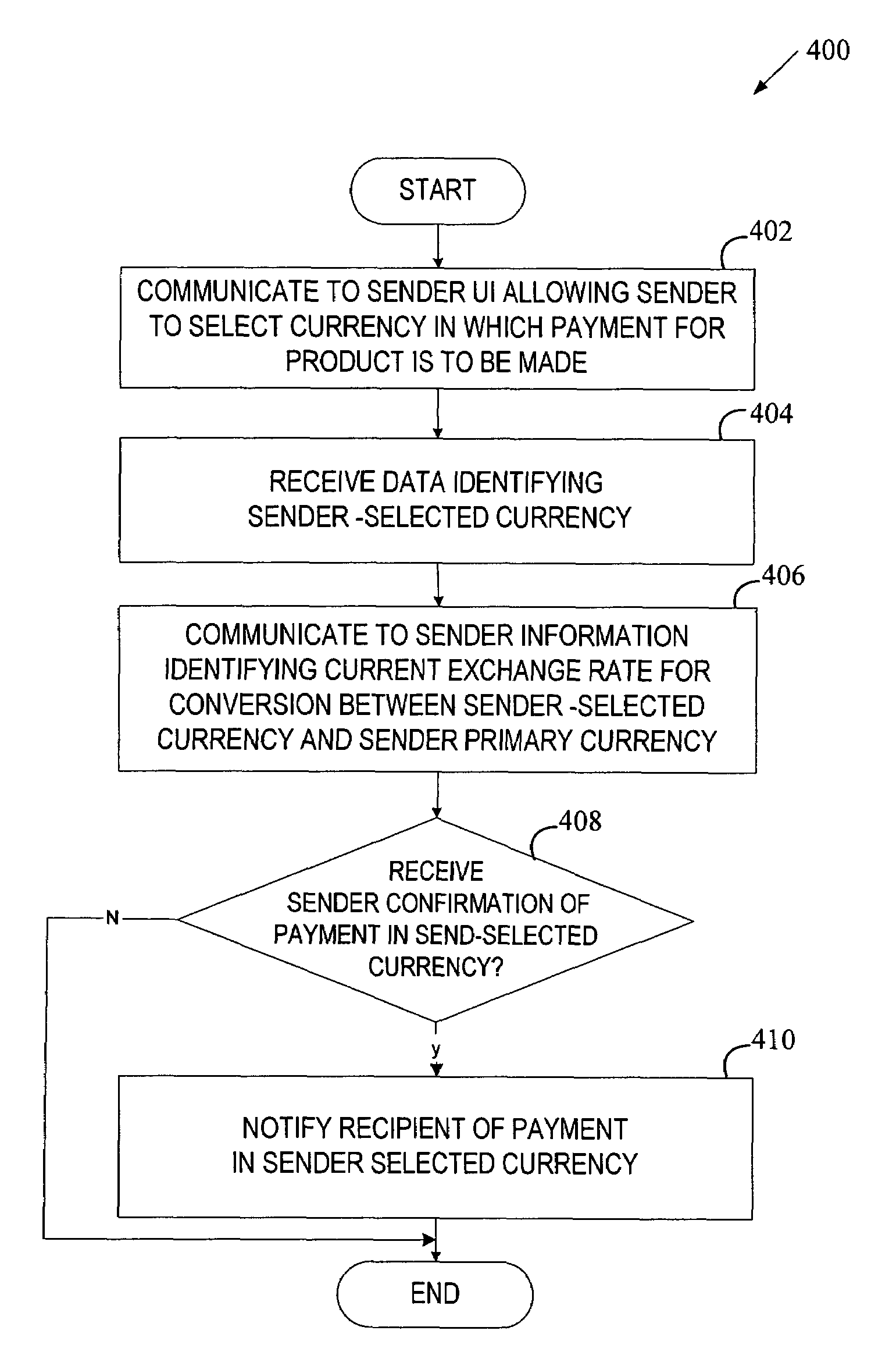

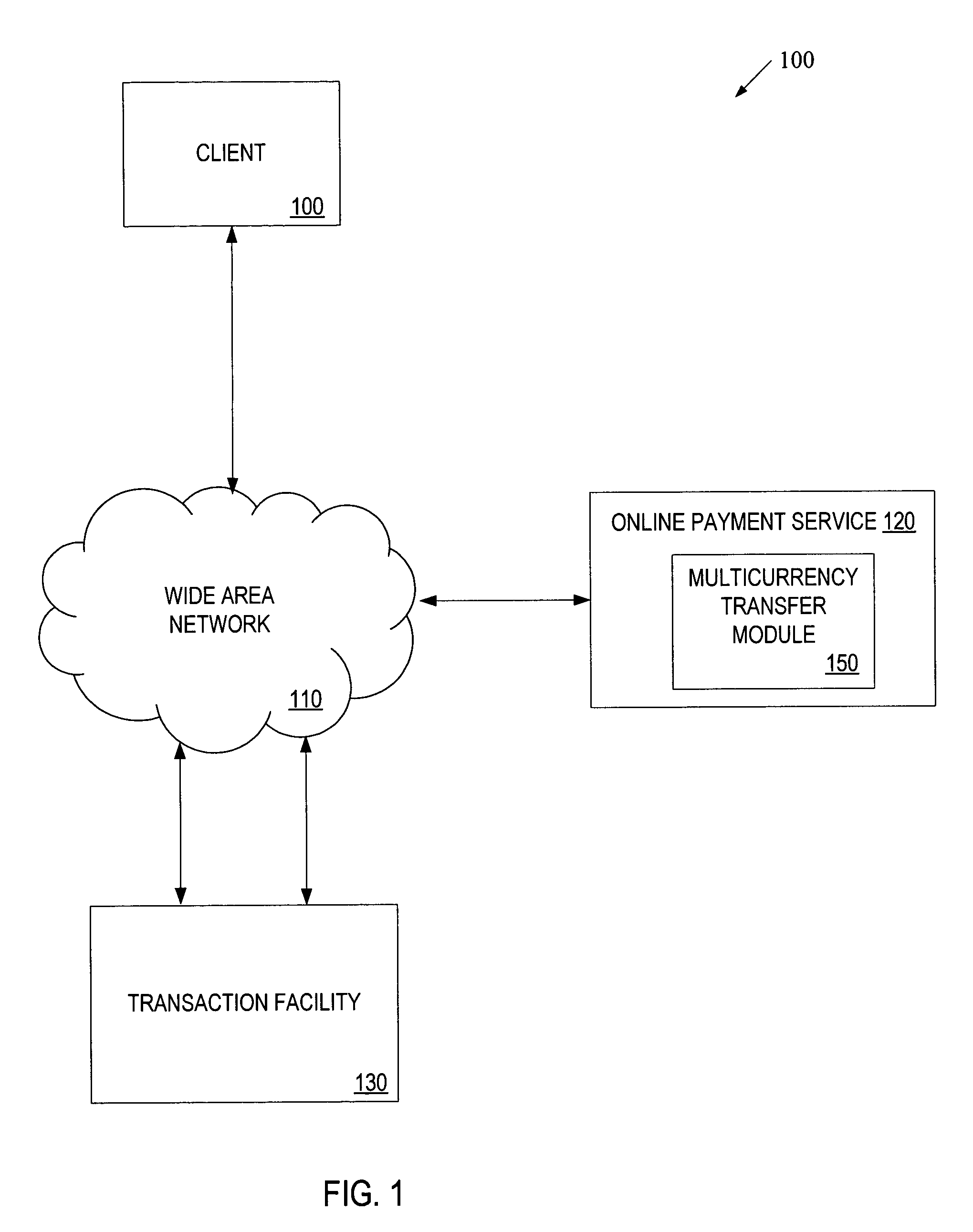

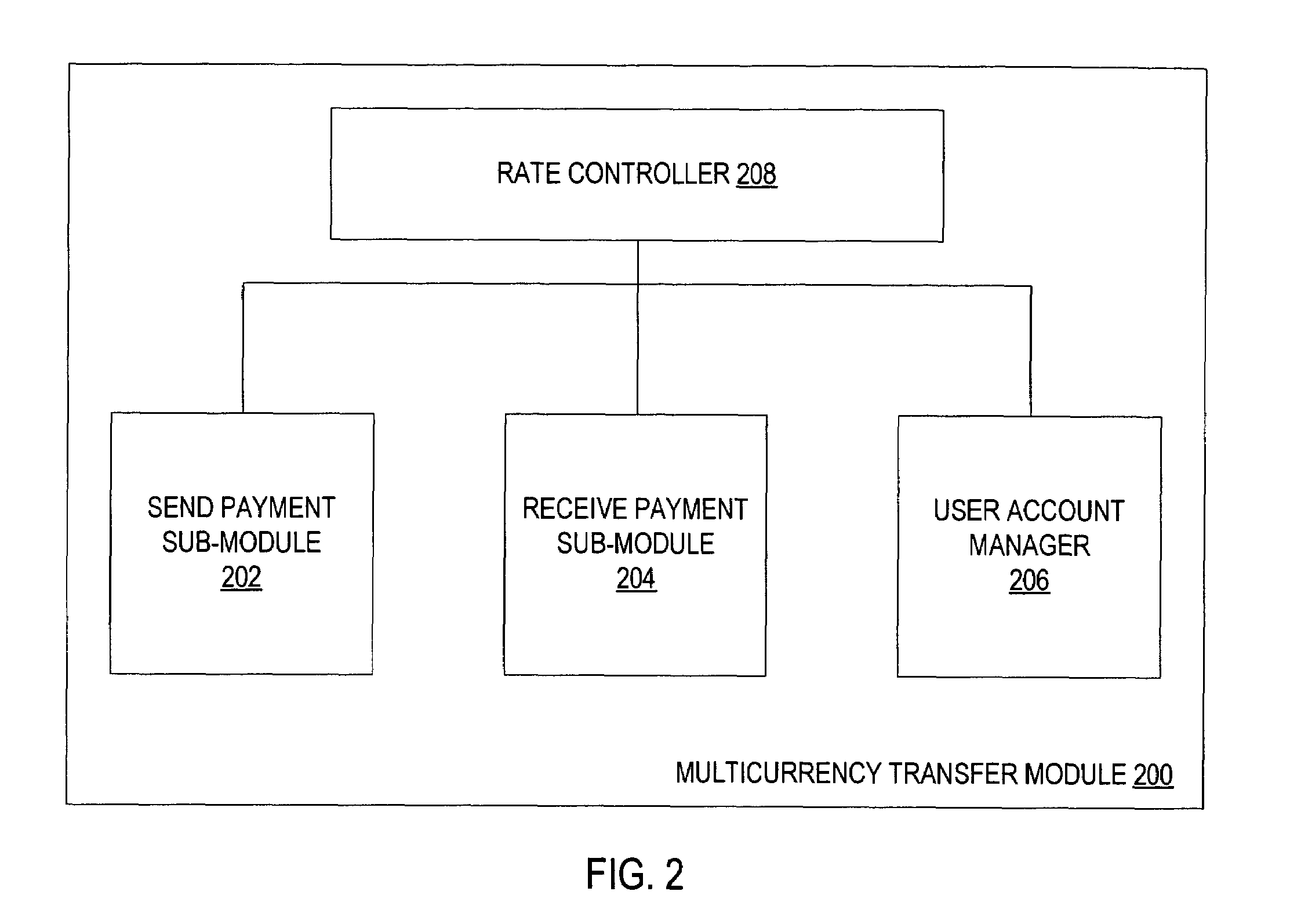

Multicurrency exchanges between participants of a network-based transaction facility

ActiveUS7742985B1Facilitating online payment transactionEasy inputFinanceCurrency conversionUser interfaceTransmitter

A method and apparatus for facilitating online payment transactions in multiple currencies between participants of a network-based transaction facility are described. In one embodiment, a user interface is communicated to a sender via a communications network. The user interface facilitates sender input with respect to a desired currency in which a payment to a recipient is to be made. Further, data identifying a sender-selected currency is received from the sender via the communications network. In response, information identifying a current exchange rate for conversion between the sender-selected currency and a sender primary currency is communicated to the sender via the communications network. If the sender confirms the payment in the sender-selected currency, the recipient is informed about the payment in the sender-selected currency.

Owner:PAYPAL INC

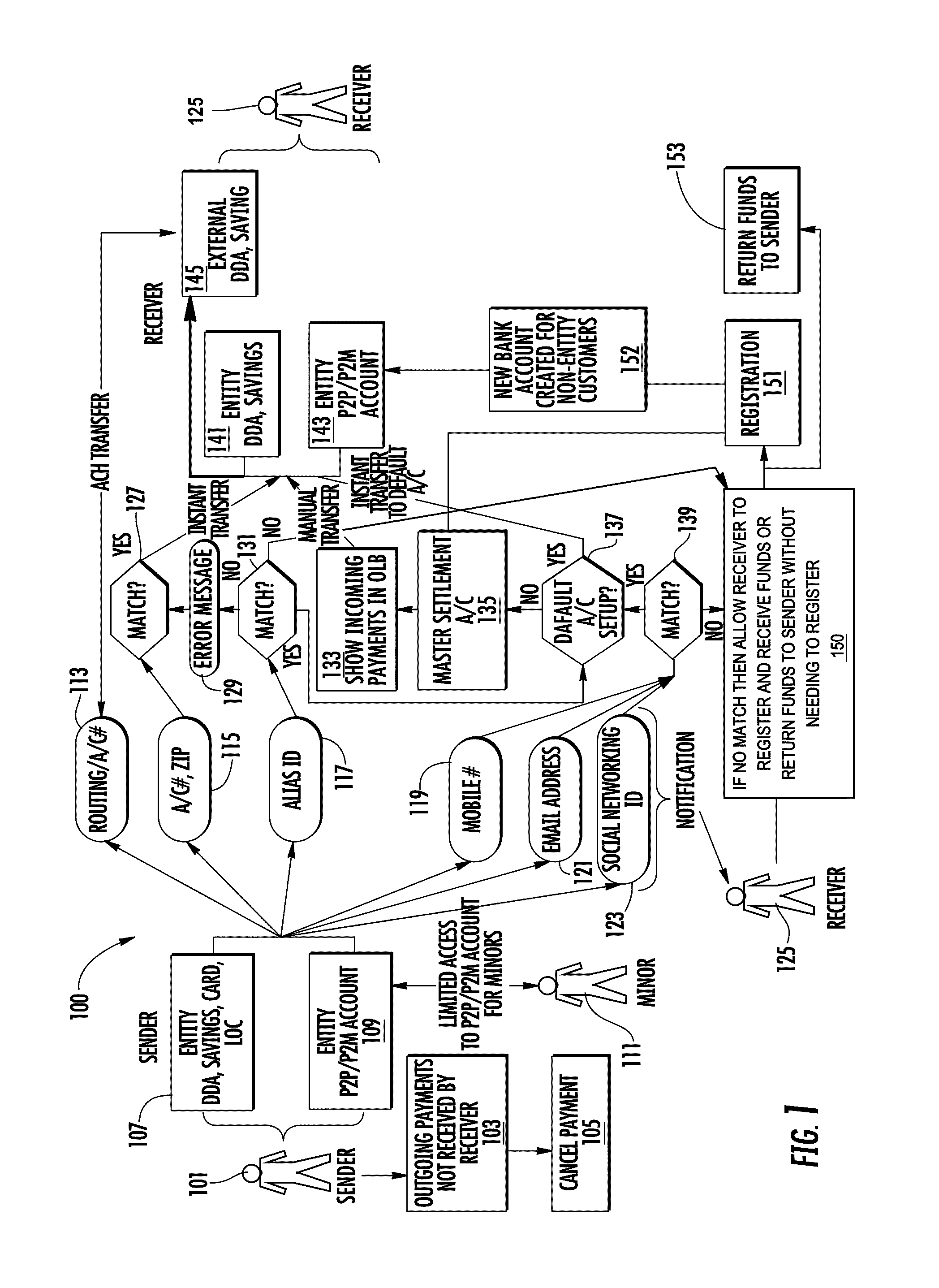

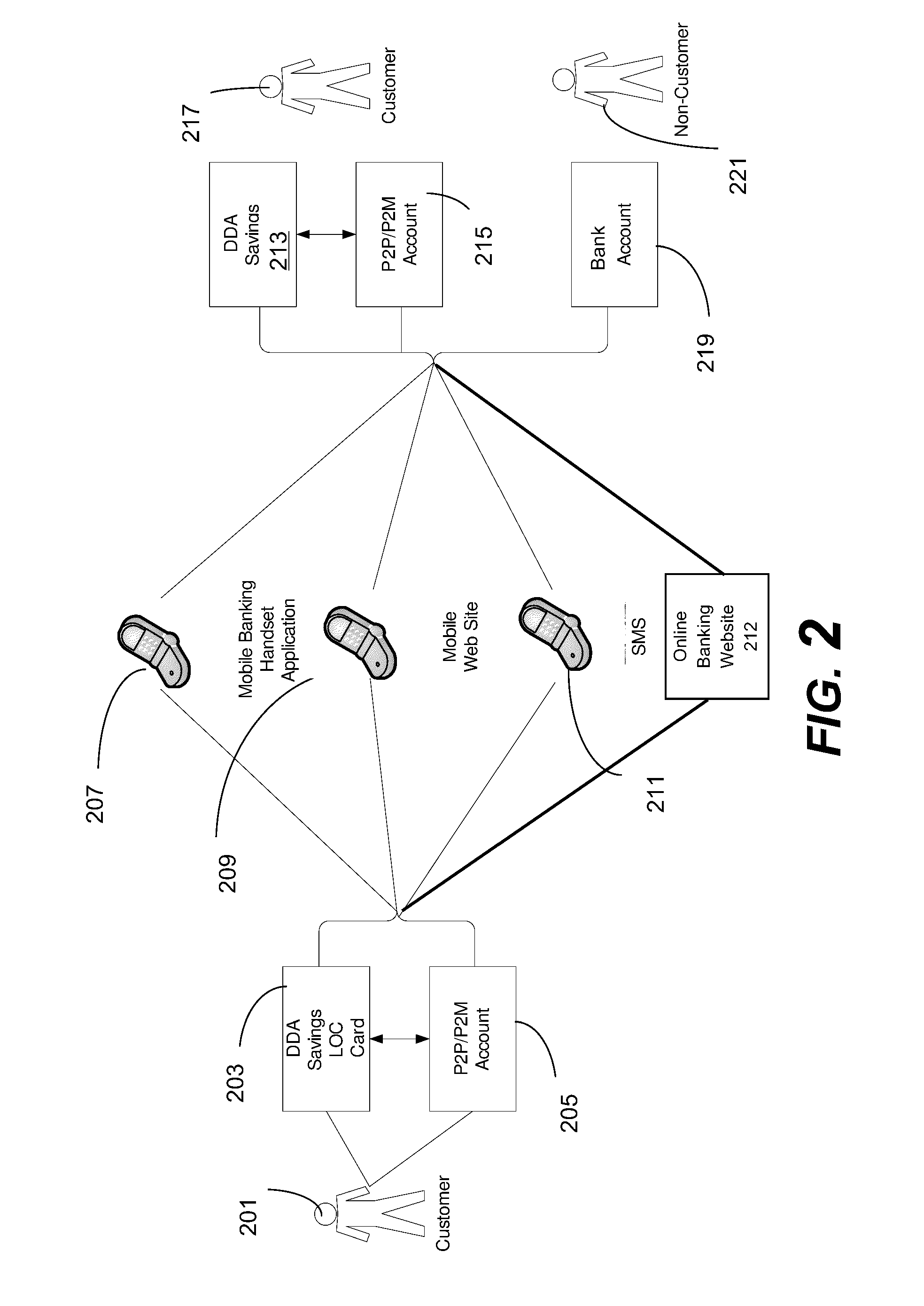

Online payment system and method

ActiveUS8725635B2User-friendly interfaceEasy to monitorFinanceProtocol authorisationThird partyInternet privacy

Owner:BANK OF AMERICA CORP

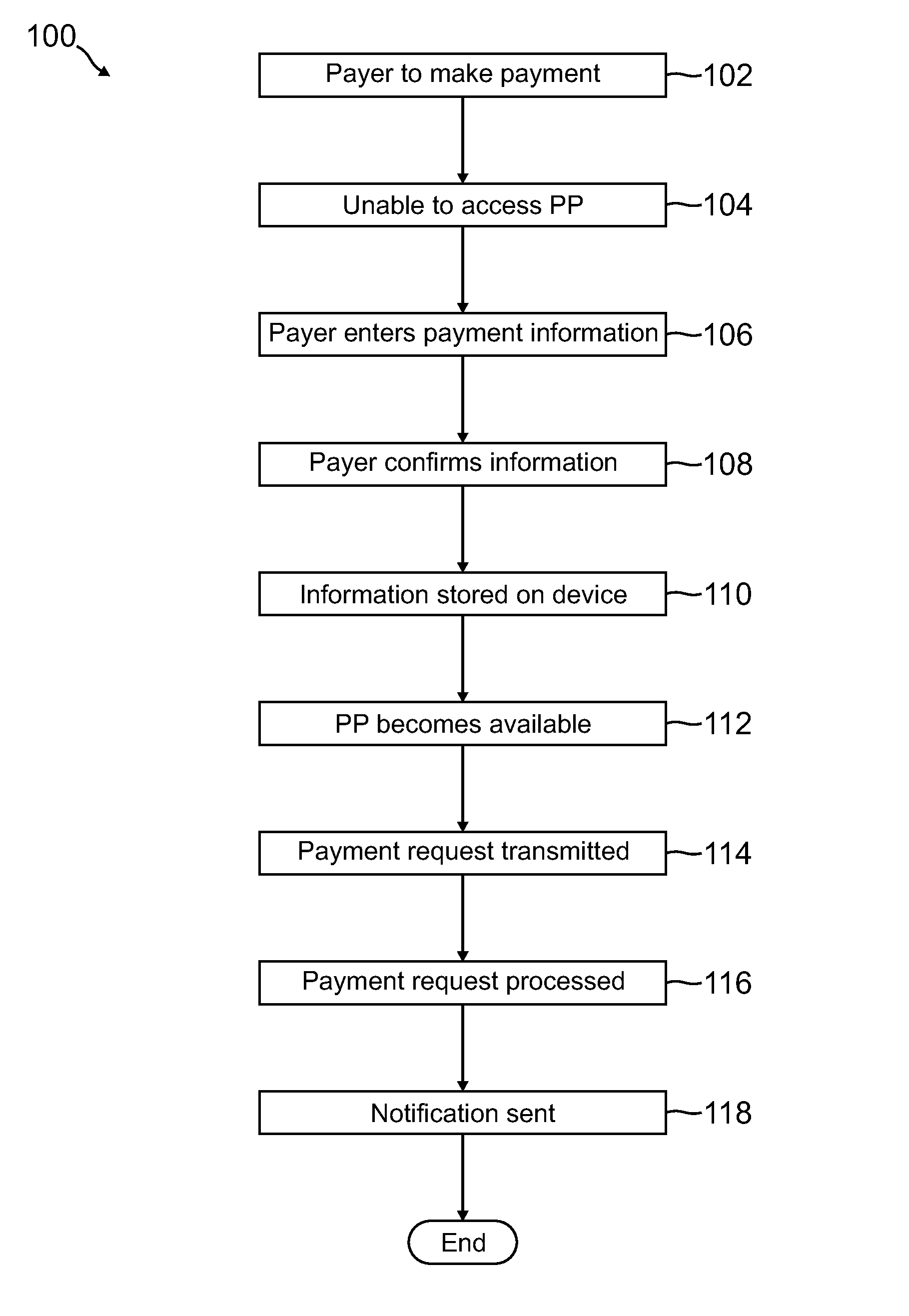

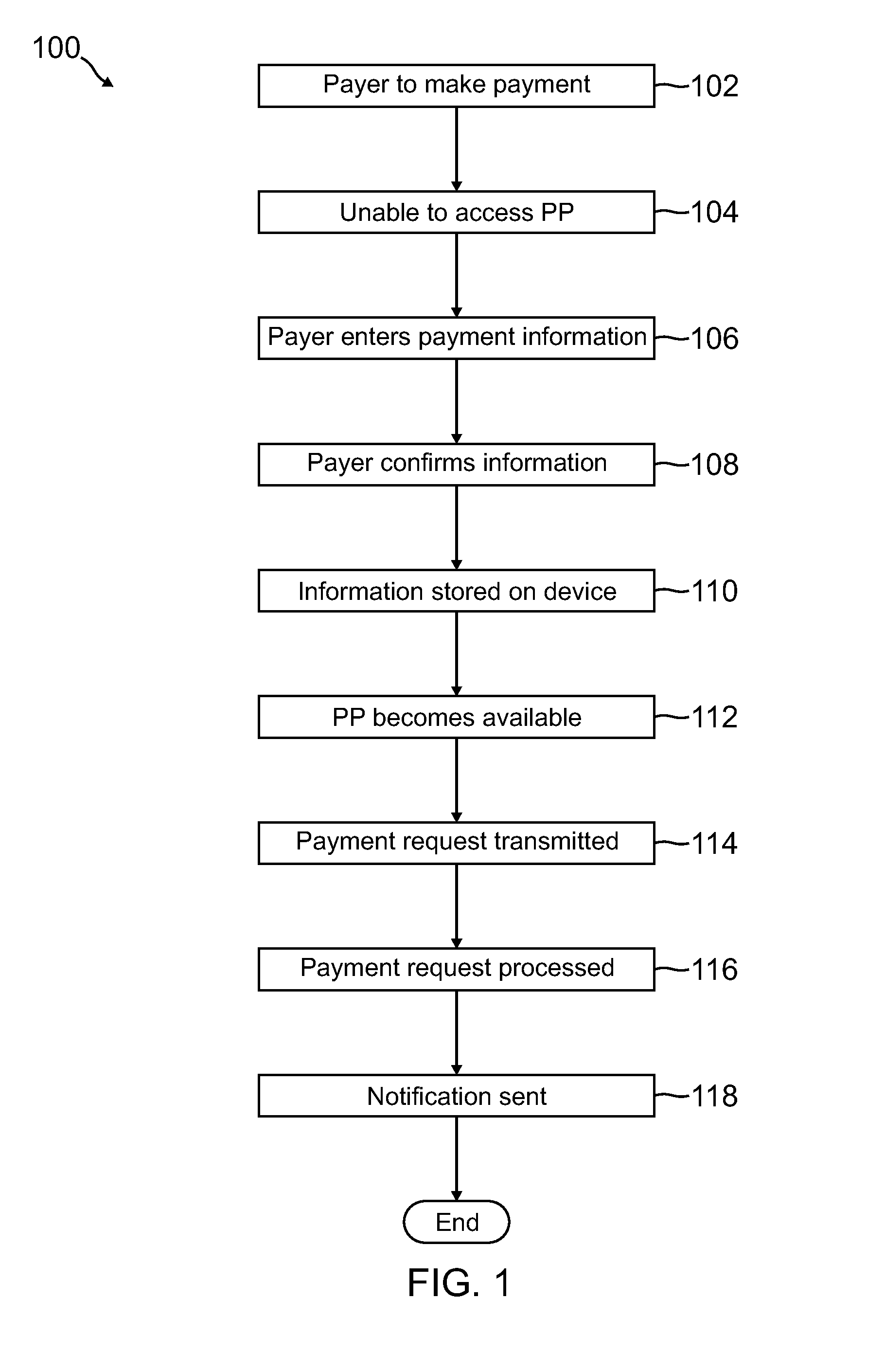

Offline to online payment

A mobile device receives an indication of a user request to initiate a payment. The mobile device provides a user interface requesting transaction information corresponding to the payment. The mobile device receives transaction data entered by the user via the user interface. In response to a determination made by the mobile device that a connection to a payment provider cannot be established. A payment request is stored at the mobile device. The payment request corresponds to the transaction data. In response to a subsequent determination made by the mobile device that a connection to the payment provider can be established. The payment request is sent to the payment provider. The payment request is configured to initiate the payment.

Owner:PAYPAL INC

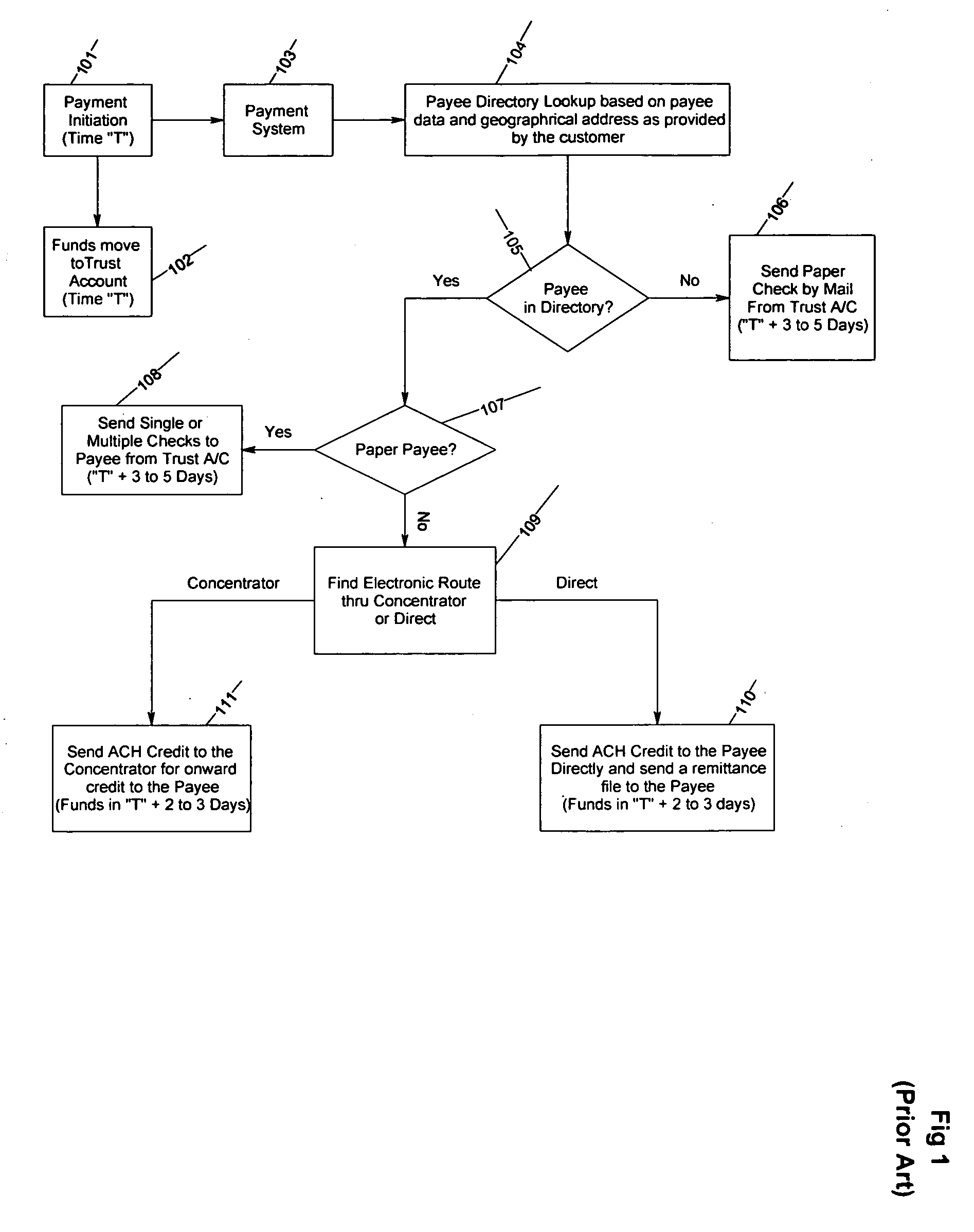

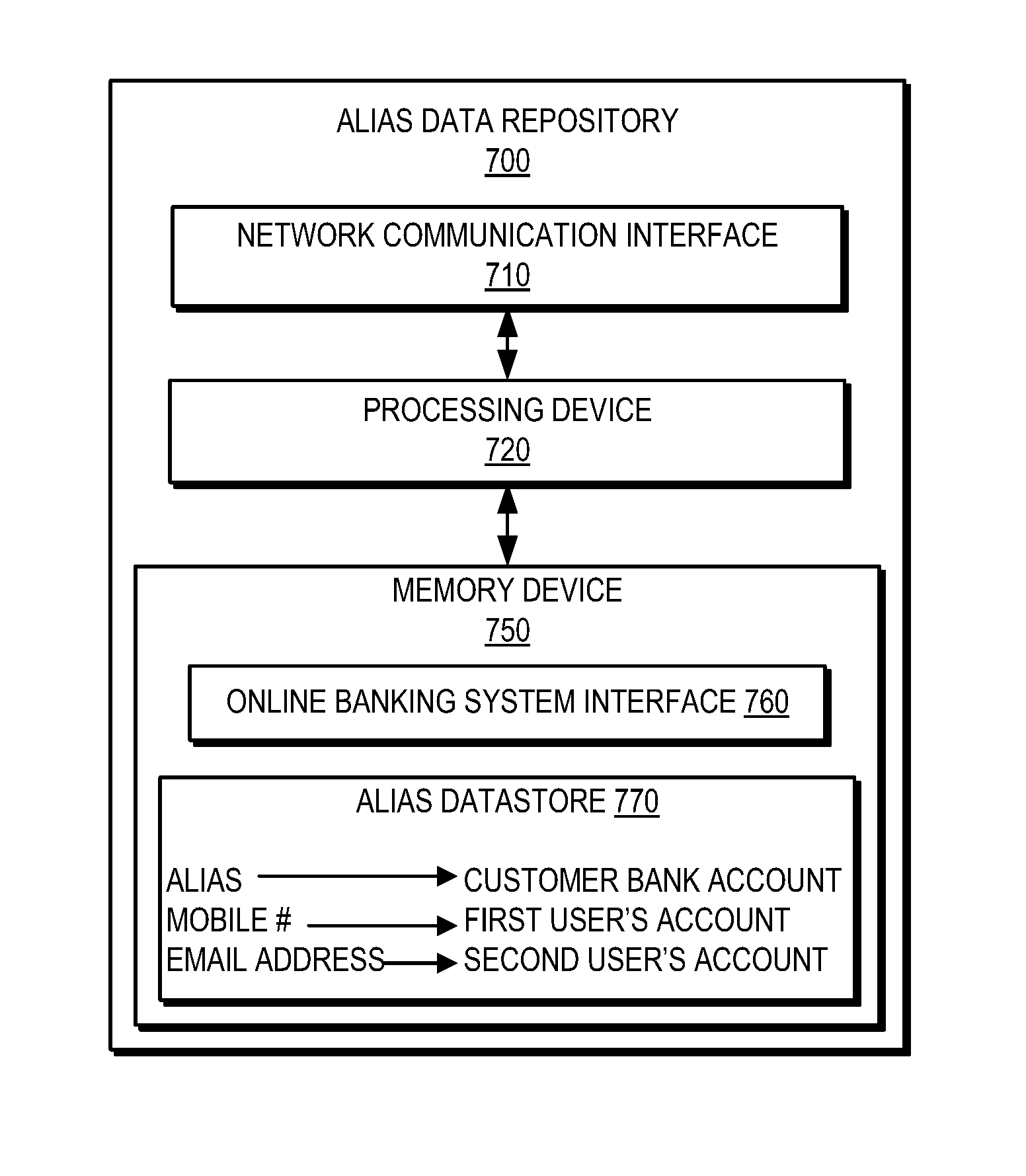

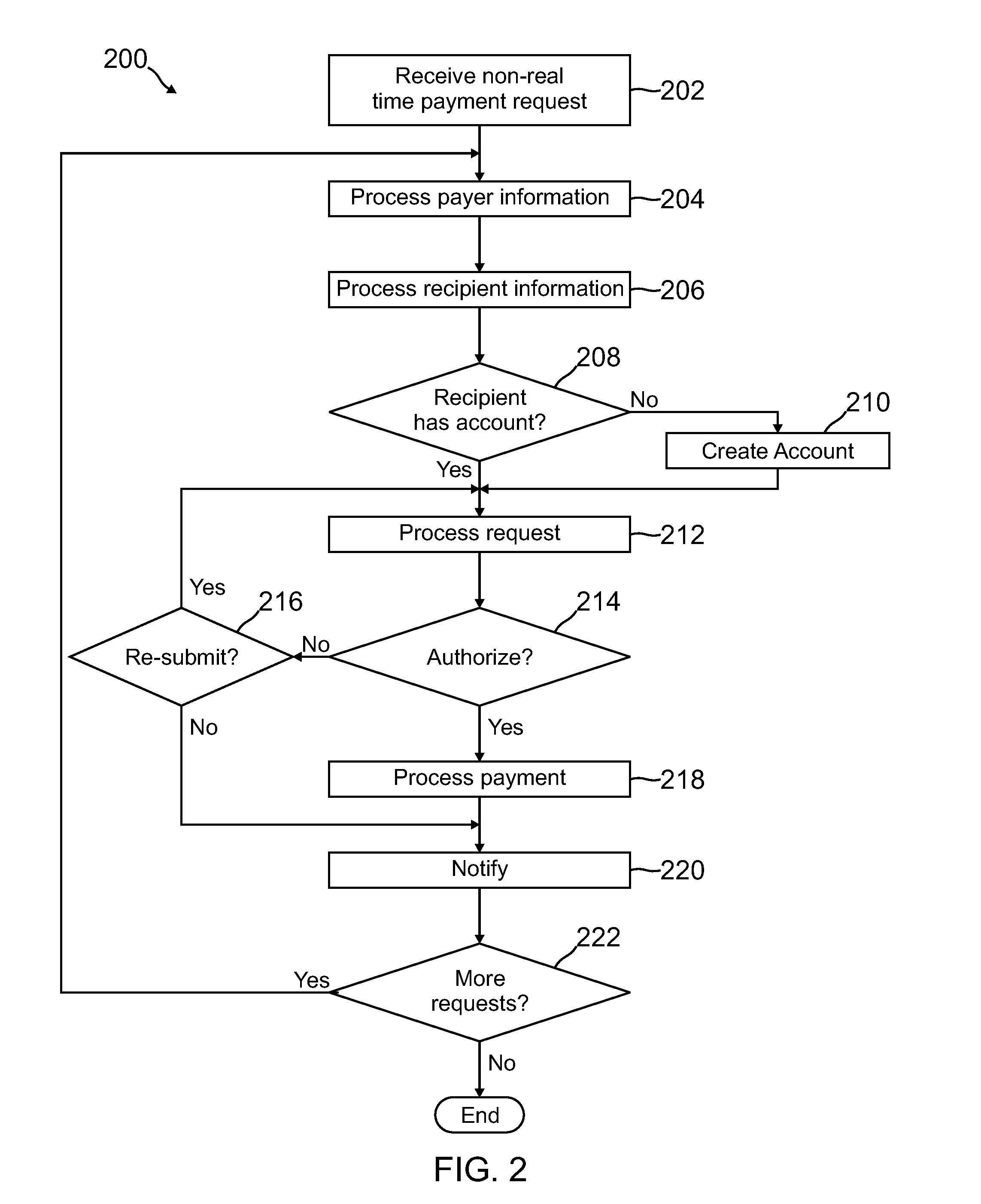

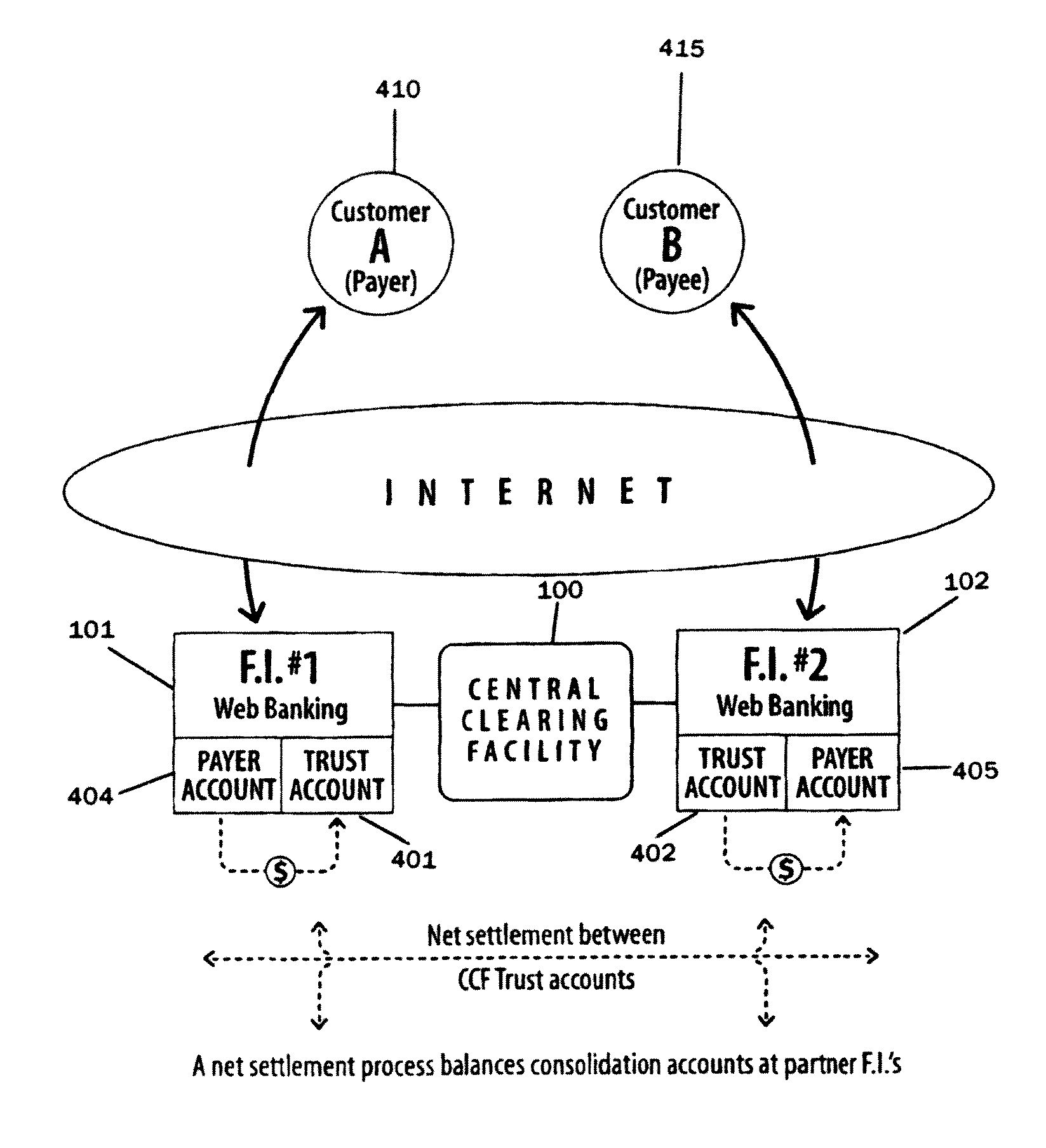

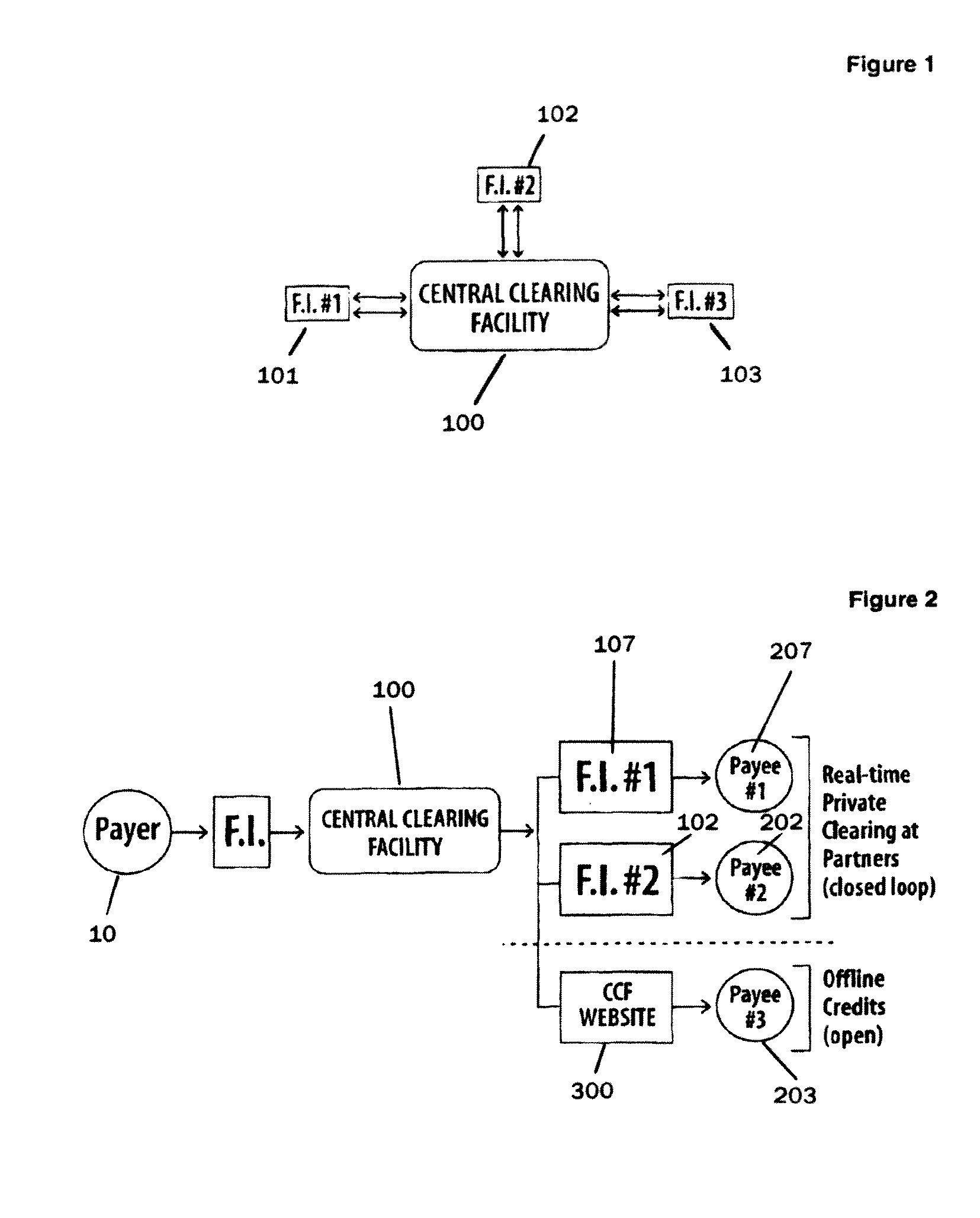

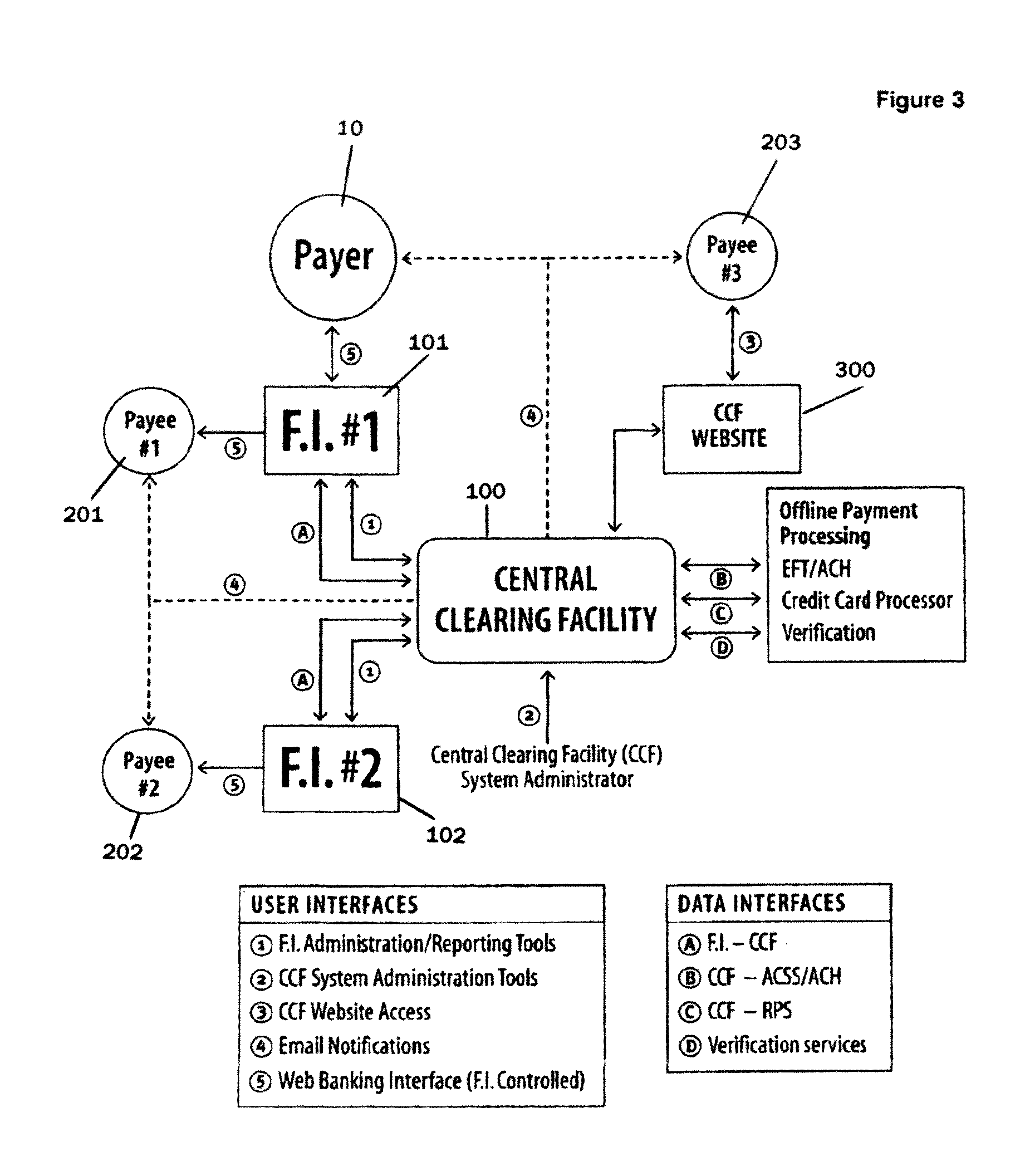

Online payment transfer and identity management system and method

ActiveUS7844546B2Facilitates online bankingFacilitating cross-sellingFinanceDigital data authenticationApplication serverIdentity management system

A payment transfer method for transferring funds from a payer to payee is provided, including designating a payee and specifying a payment amount and an account; debiting the funds from the account and crediting a first trust account; and identifying the payee by verifying responses received in response to one or more challenge-response questions defined by the payer. If the one or more responses are verified, a second trust account may be debited and a payee account credited with the payment amount. The first and second trust accounts may then be reconciled. There is also provided a payment transfer facility for transferring funds., comprising an application server for storing payment data relating to a transfer of funds and a notification server for providing a notification of the transfer of funds.

Owner:INTERAC CORP

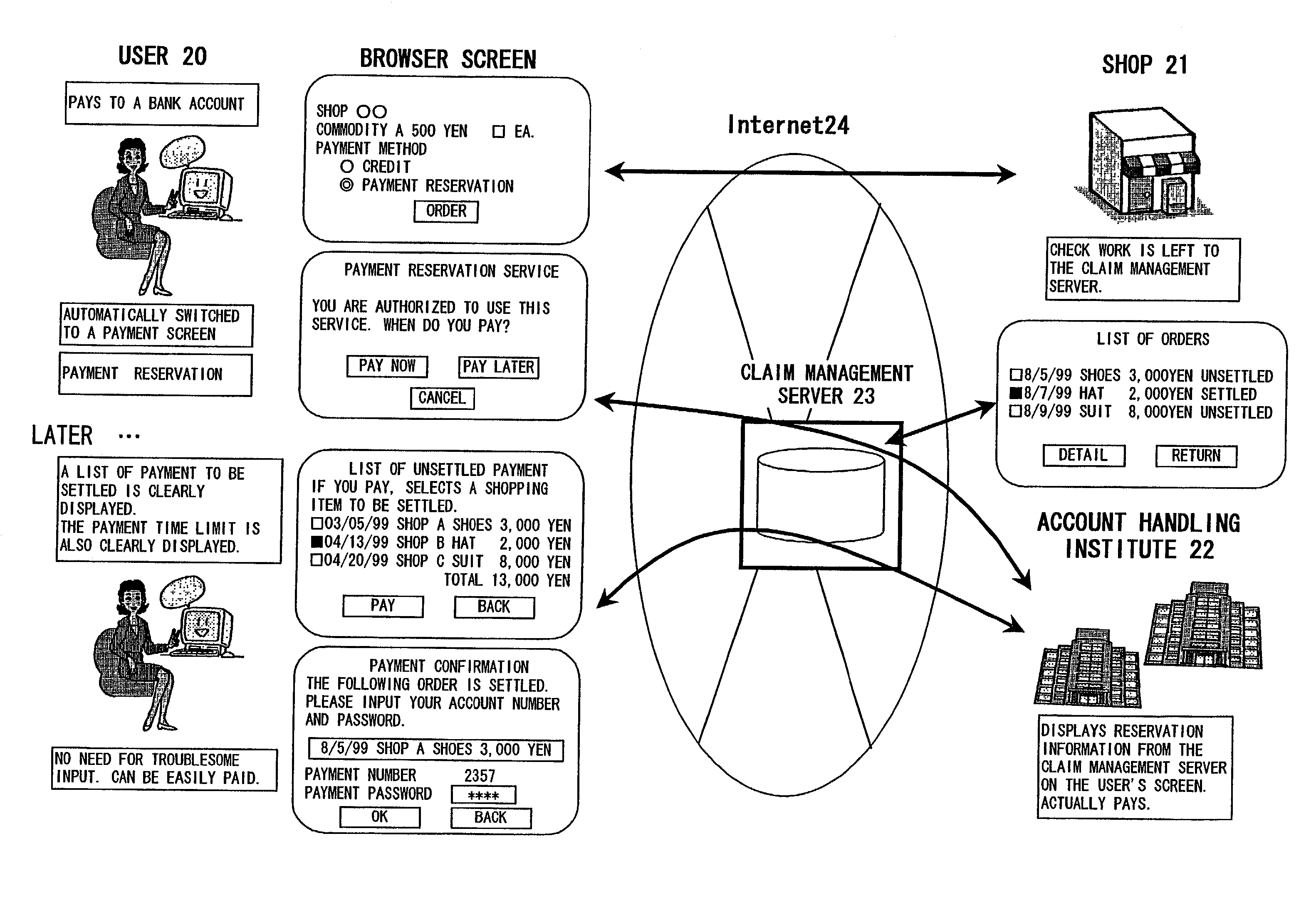

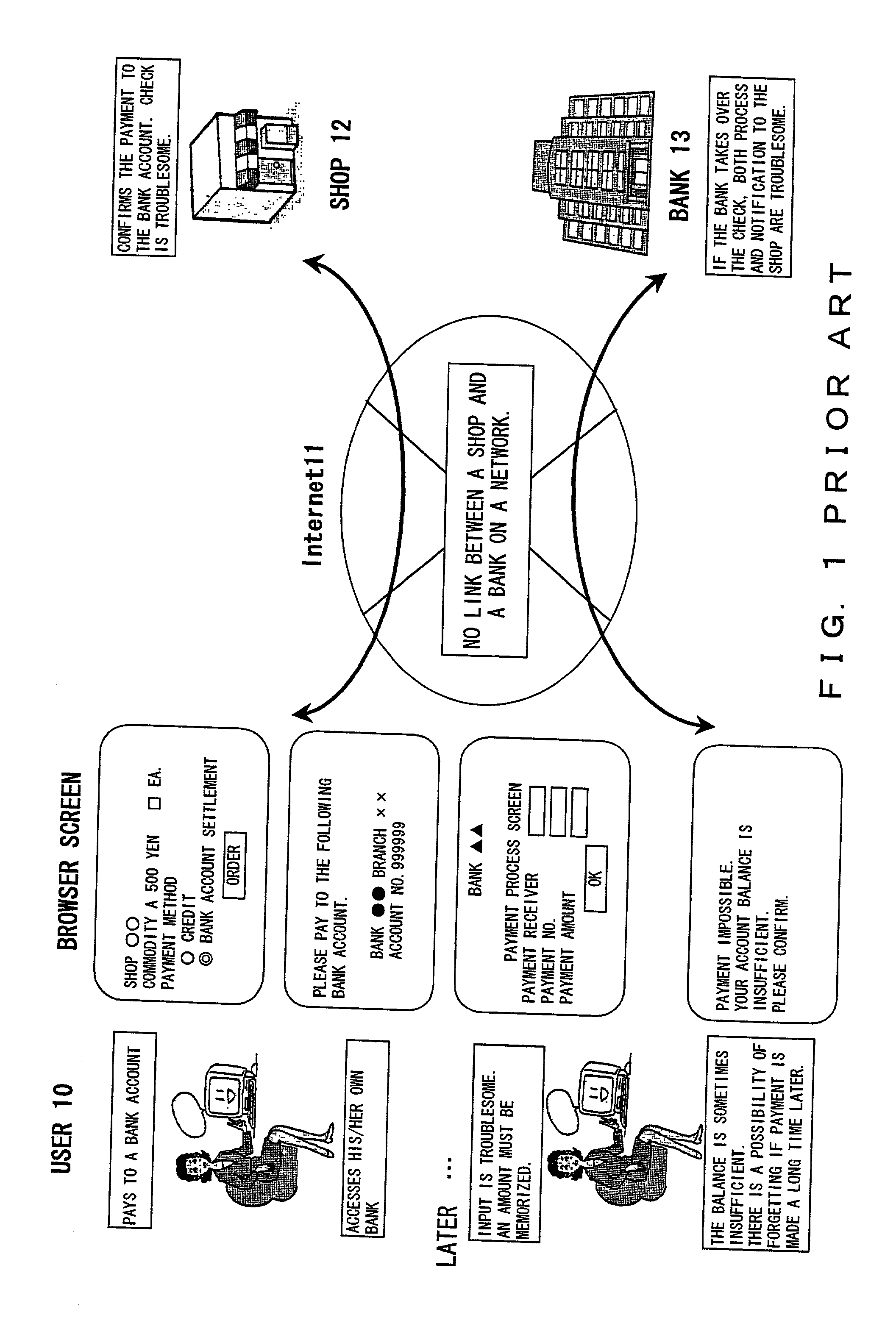

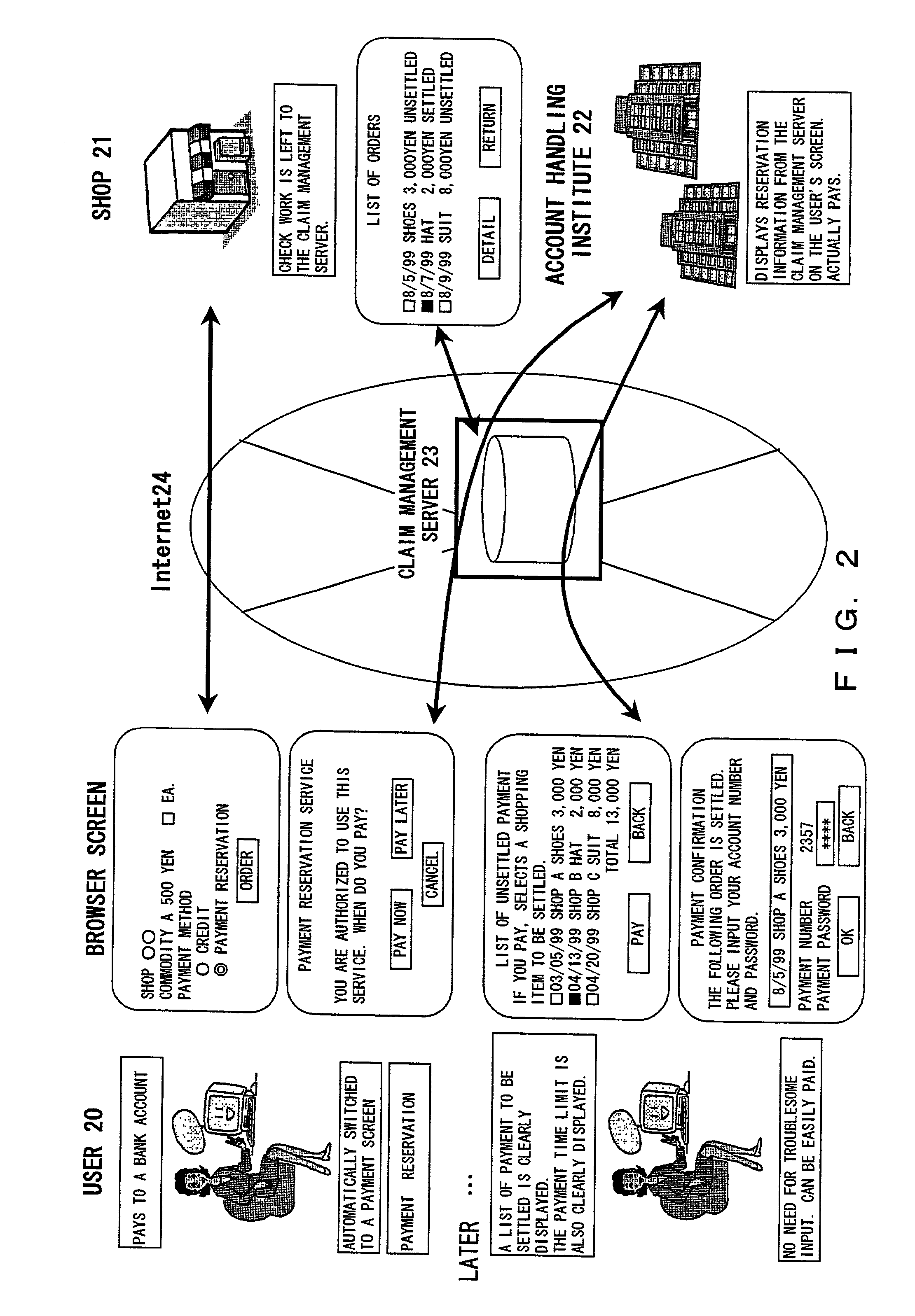

Online settlement system, method thereof and storage medium

When a user does shopping on a commodity purchase screen provided by a shop via the Internet, the user uses a payment reservation service provided by a claim management server. Then, the claim management server stores the shopping content of the user as a database and simultaneously stores both a payment amount and a settled / unsettled payment status in the shopping contents. The user views the list of unsettled payment of the shopping content provided by the claim management server, selects a shopping item, the price payment of which the user is going to settle, designates an account handling institute to use and settles payment online. The claim management server automatically does the check work of the shopping content, the price payment of which is settled.

Owner:FUJITSU LTD

Secure Online Payment System And Online Payment Authentication Method

InactiveUS20070288392A1Improve processing effectivenessLow costPayment circuitsSecuring communicationThe InternetHandling system

An online payment system and a secure authentication method, including a customer, a merchant and a payment gateway connected over Internet; said payment gateway is responsible for processing payment information from the network, authenticating identities of the customer and the merchant and validating the validity of transaction; after a processing system in the payment gateway confirms the transaction is valid, said payment gateway sends a payment request and informs the two parties in the transaction of the payment information after the payment is accomplished; an assistant customer identity authentication system is arranged between the payment gateway and the customer, which connects the customer to the payment gateway in a non-Internet approach; the payment gateway generates an authorization code dynamically and transfers it to the customer via the assistant customer identity authentication system; the customer enters the authorization code on correct page in the payment gateway to pass identity authentication. The authentication method and the payment system greatly reduce the possibility that online data is stolen, by using both Internet and non-Internet authentication mode, and thereby improves security of online payment and delivers flexibility and convenience.

Owner:CHINA UNIONPAY

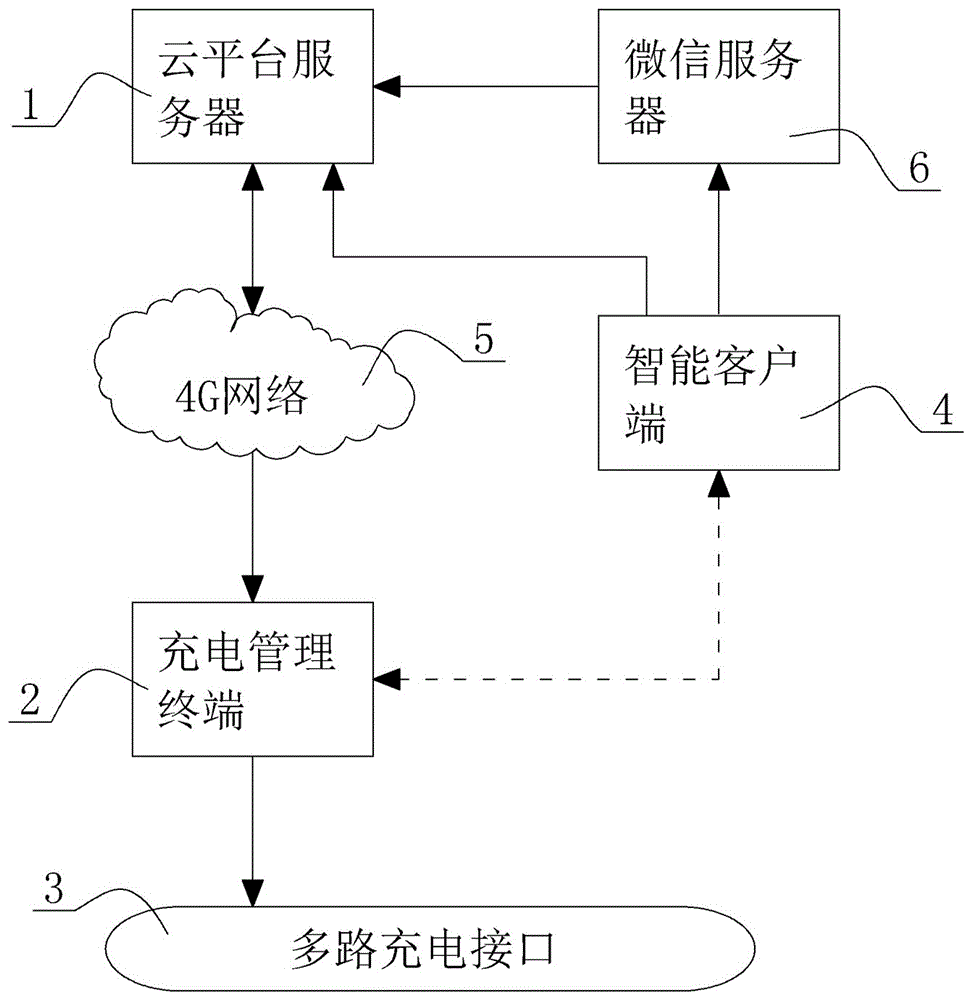

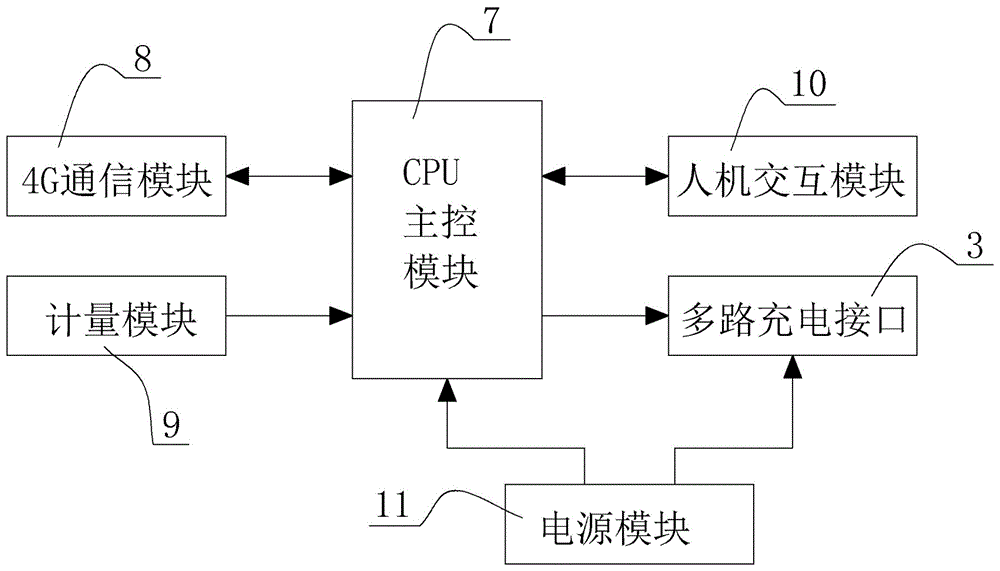

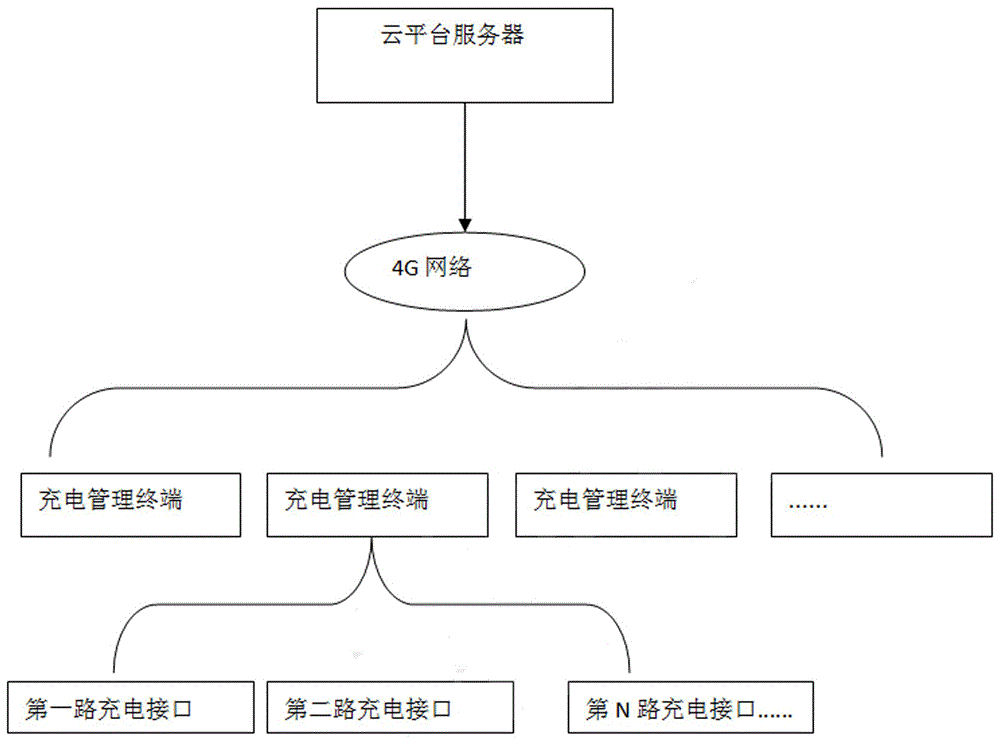

Distributed type electric vehicle charge management system based on cloud platform and multiple tenants as well as method

InactiveCN106097587AHigh speed communicationStable communicationElectric vehicle charging technologyApparatus for hiring articlesComputer terminalElectric vehicle

The invention discloses a distributed type electric vehicle charge management system based on a cloud platform and multiple tenants. The system comprises a cloud platform server, a charge management terminal, a WeChat server and a smart client loaded with a charge APP, wherein the cloud platform server realizes online management of the charge management terminal through 4G network. The management method comprises steps as follows: a), selecting a user type; b), executing payment by a user with an IC (integrated circuit) card; c), executing payment by a user without an IC card; d), executing payment by an APP user; e), executing charging; f), judging whether the charging is completed; g), finishing settlement of transactions. According to the charge management system and method, online management of the charge management terminal is realized, the user can complete online payment and charge operation through IC card, APP or WeChat, a conventional offline and isolated business mode of a charging pile is changed, the beneficial effects are remarkable, and the system and the method are suitable for being applied and popularized.

Owner:刘世和 +1

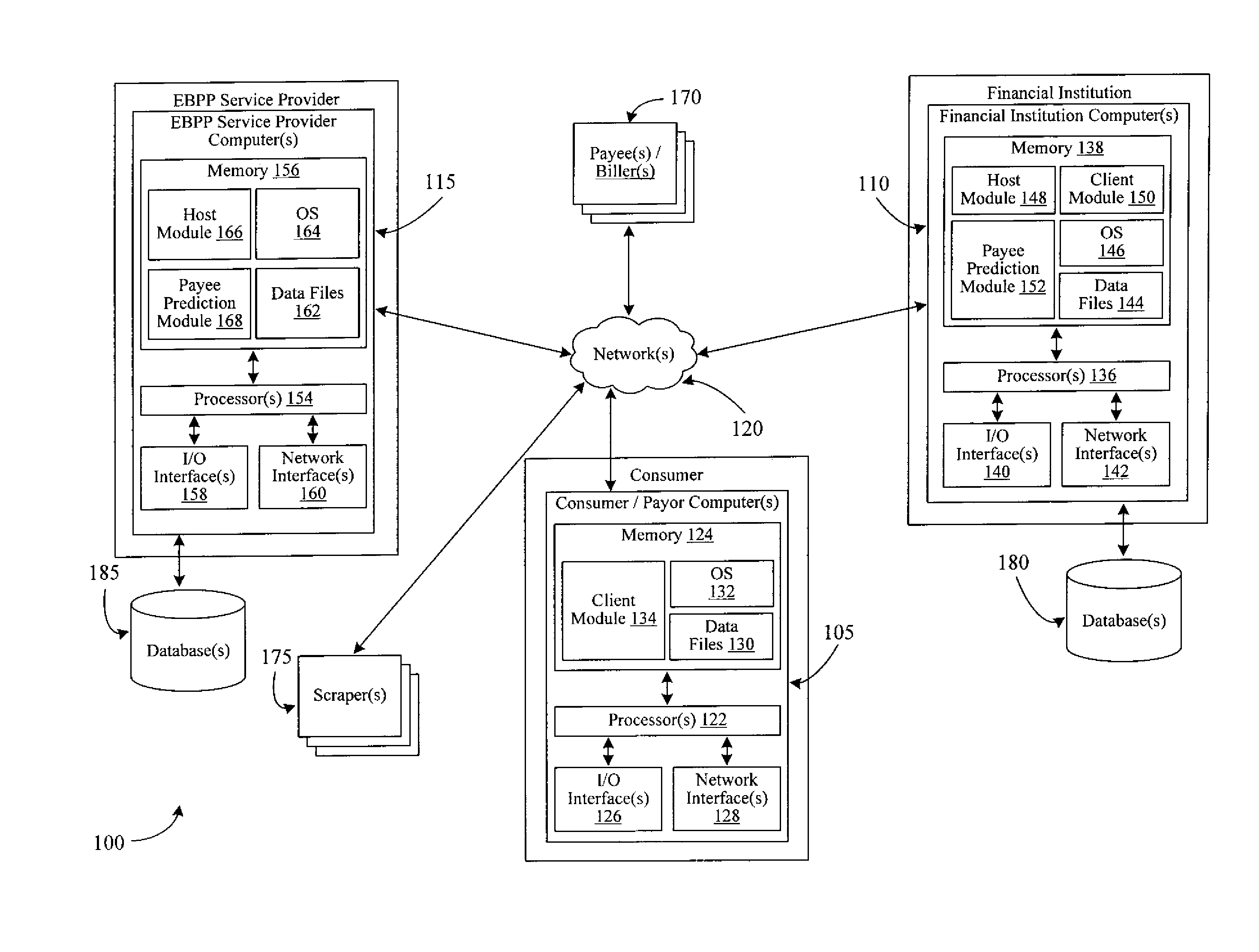

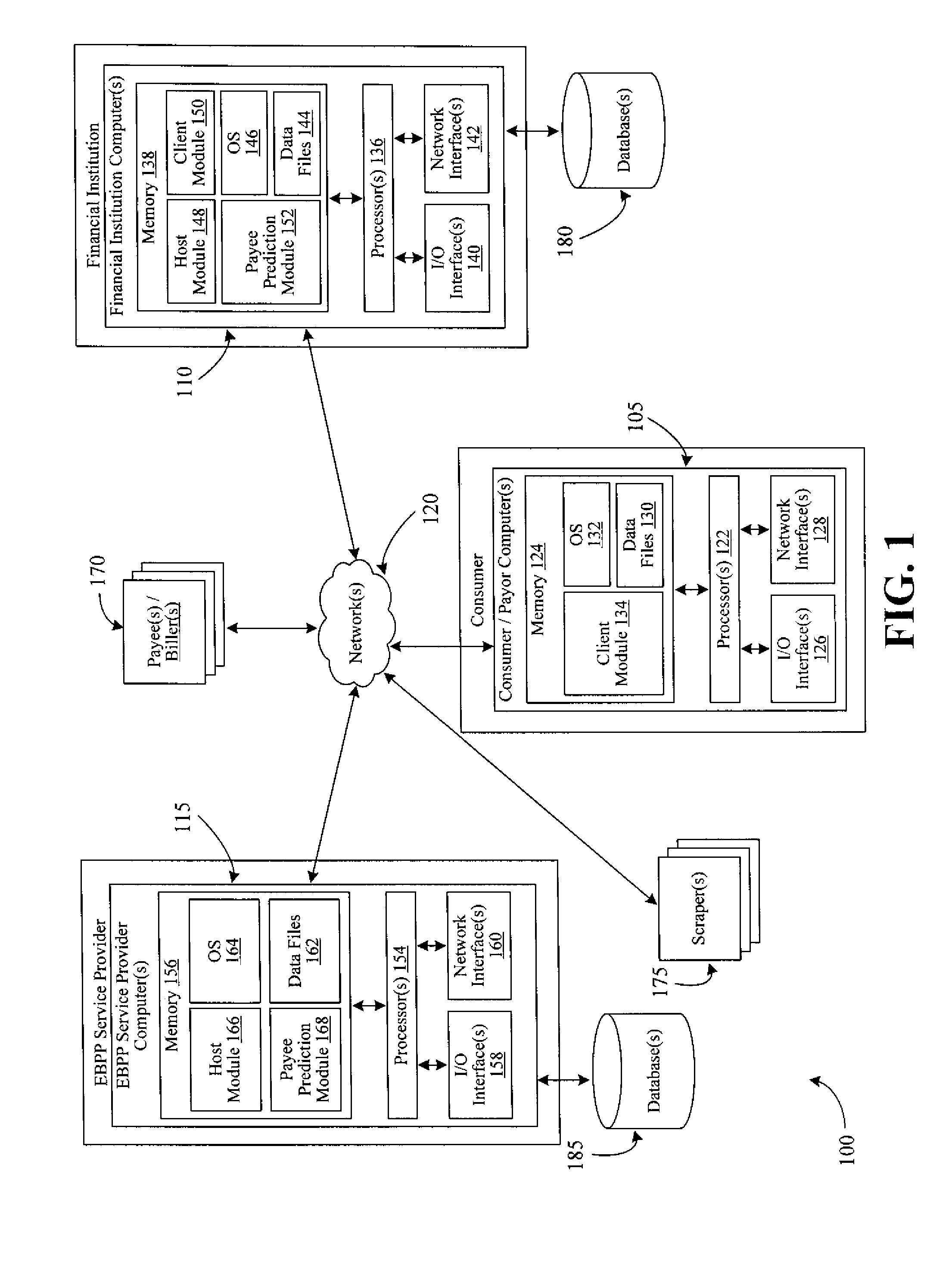

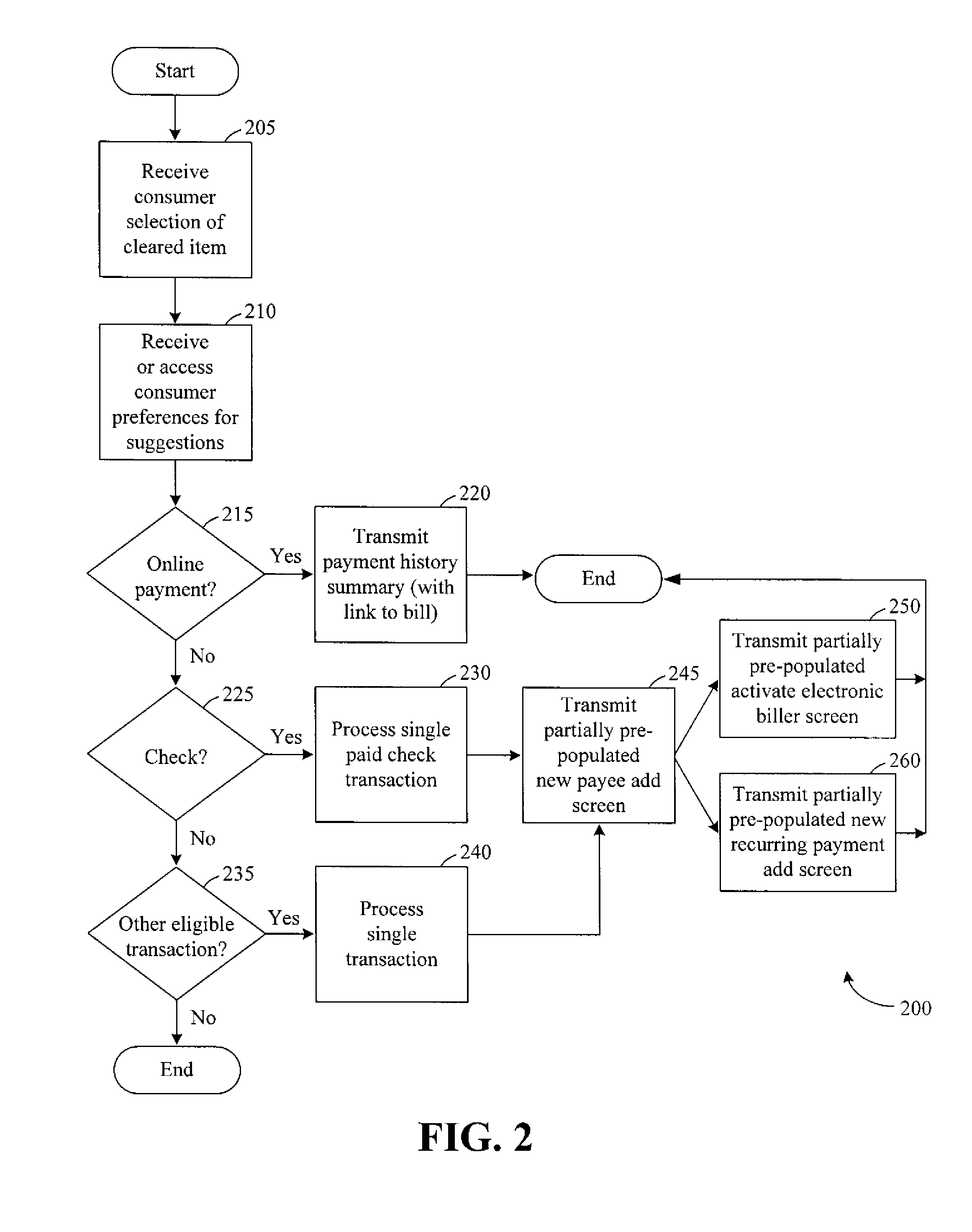

Systems, methods, and apparatus for establishing payees based on cleared items posted to a financial account

Systems, methods, and apparatus for establishing payees based on cleared items posted to a financial account are provided. Information associated with a cleared item posted to a financial account of a consumer may be obtained. Based at least in part on the obtained information, a payee associated with the cleared item may be identified. A form may be generated for activating, at a service provider, at least one of online payment functionality for payments made to the payee by the service provider on behalf of the consumer or electronic bill presentment of billing information of the payee to the consumer through the service provider. The form may be transmitted to a network entity for presentation to the consumer.

Owner:FISERV

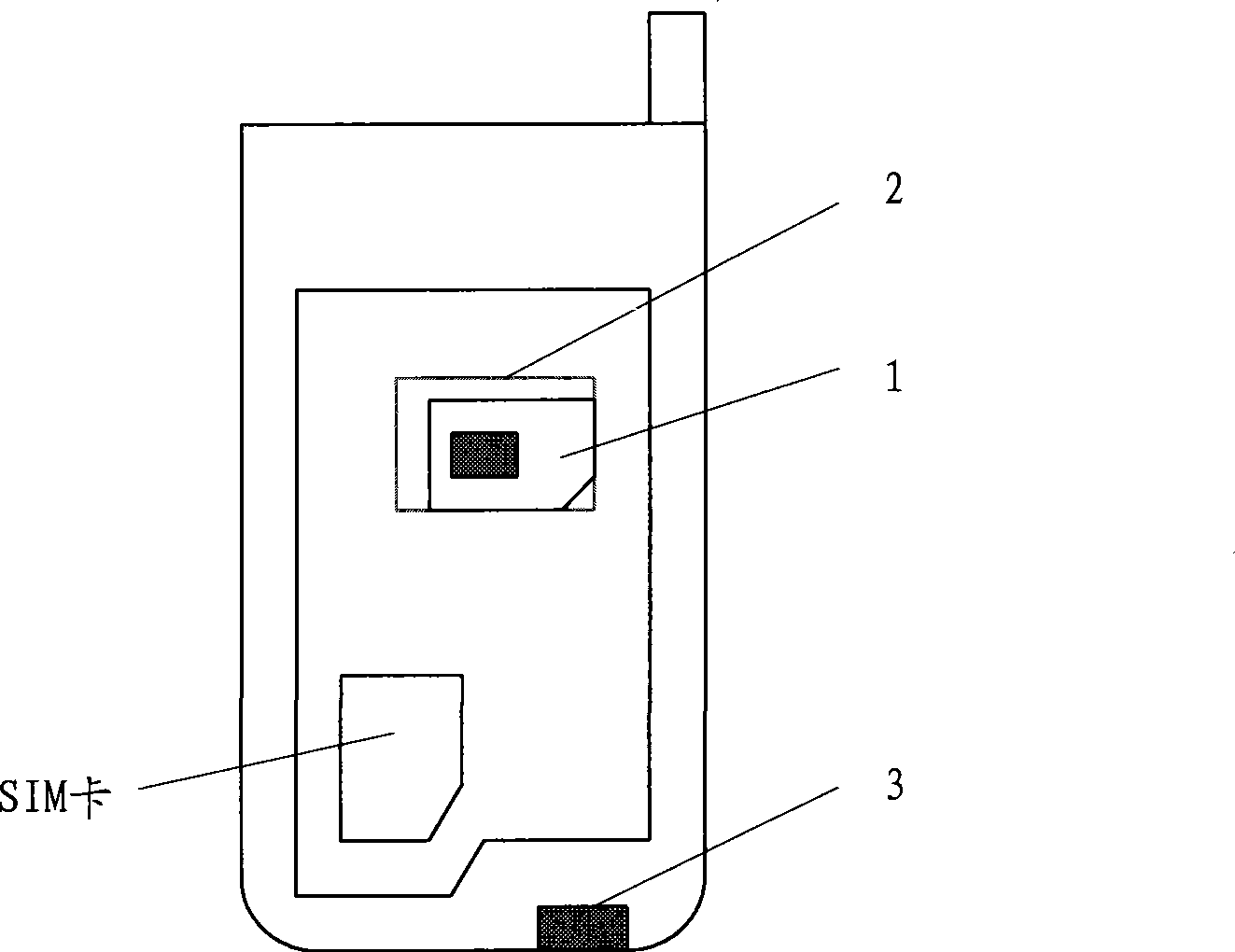

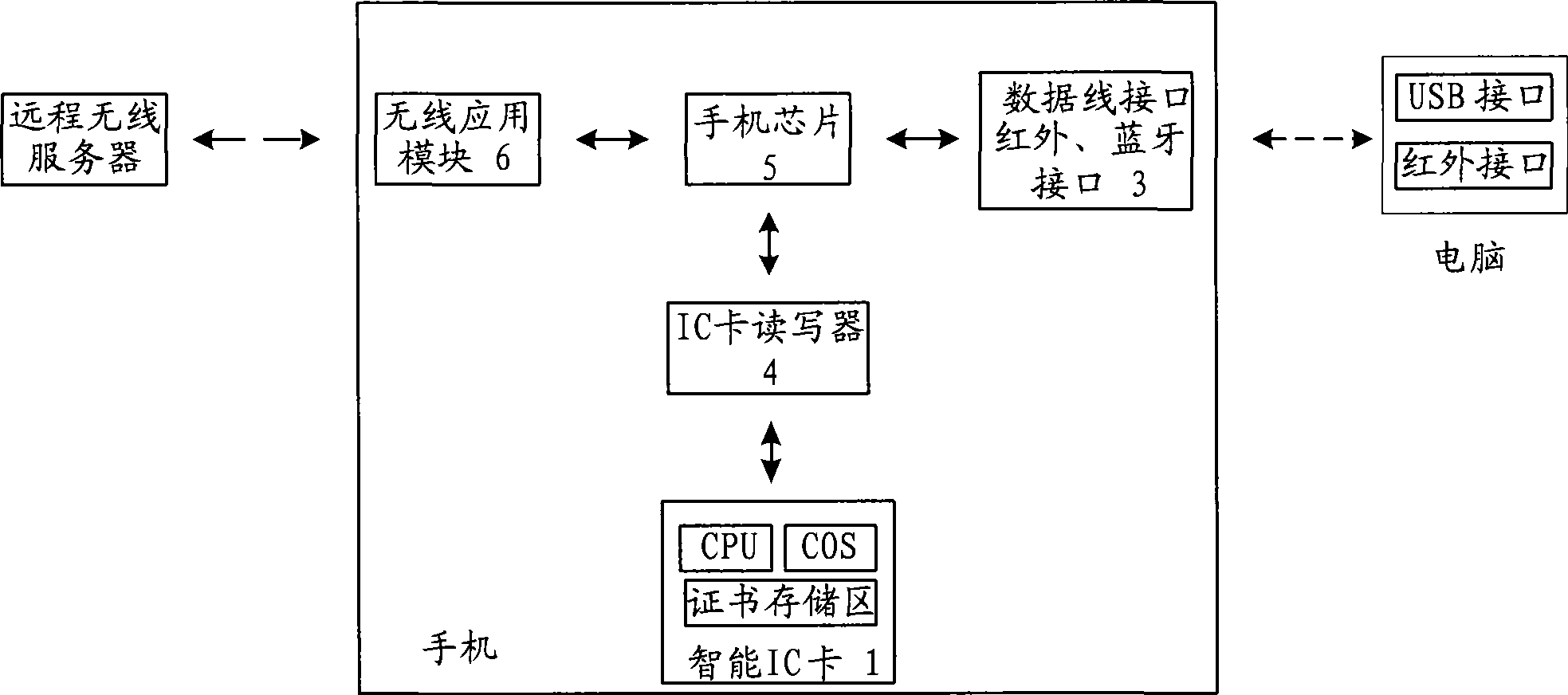

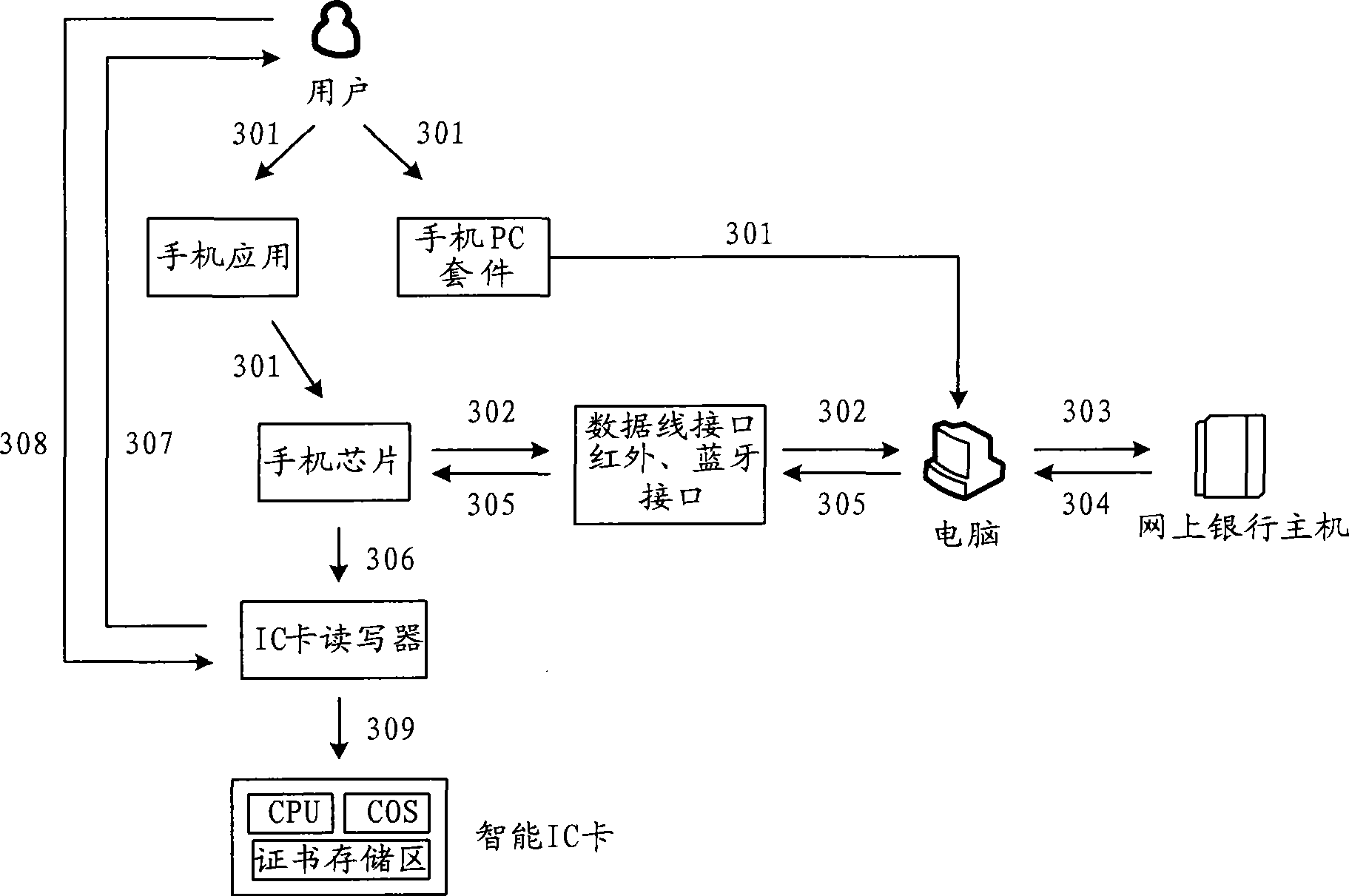

Mobile payment terminal and payment method based on PKI technique

ActiveCN101394615AImprove securityAdd control functionRadio/inductive link selection arrangementsSubstation equipmentInformation transmissionSmart card

The invention discloses a mobile payment terminal and a payment method based on the PKI technology, which aim to solve the problem that risks and hidden troubles are existed both on an ID authentication mechanism and an information transmission mechanism in the existing mobile phone payment service. The mobile payment terminal comprises a smart card, a smart card reader-writer, a terminal chip added with the control function and a data interface; the smart card is used for the storage and the application of a digital certificate; the smart card reader-writer is used for performing the read-write operation and clear operation on the smart card; the terminal chip to which the control function is added is used for controlling the smart card reader-writer to access the smart card; and the data interface is used for providing the data communication between the terminal chip and peripheral equipment. A user utilizes the mobile payment terminal to download the digital certificate to the smart card, and complete the secure mobile payment. In addition, the user can also use the mobile terminal to carry out secure online payment instead of a USB KEY when the mobile payment terminal is connected with the peripheral equipment through a data wire or interfaces such as an infrared interface, a Bluetooth interface, and the like.

Owner:CHINA UNIONPAY

Online debit cardless debit transaction system and method

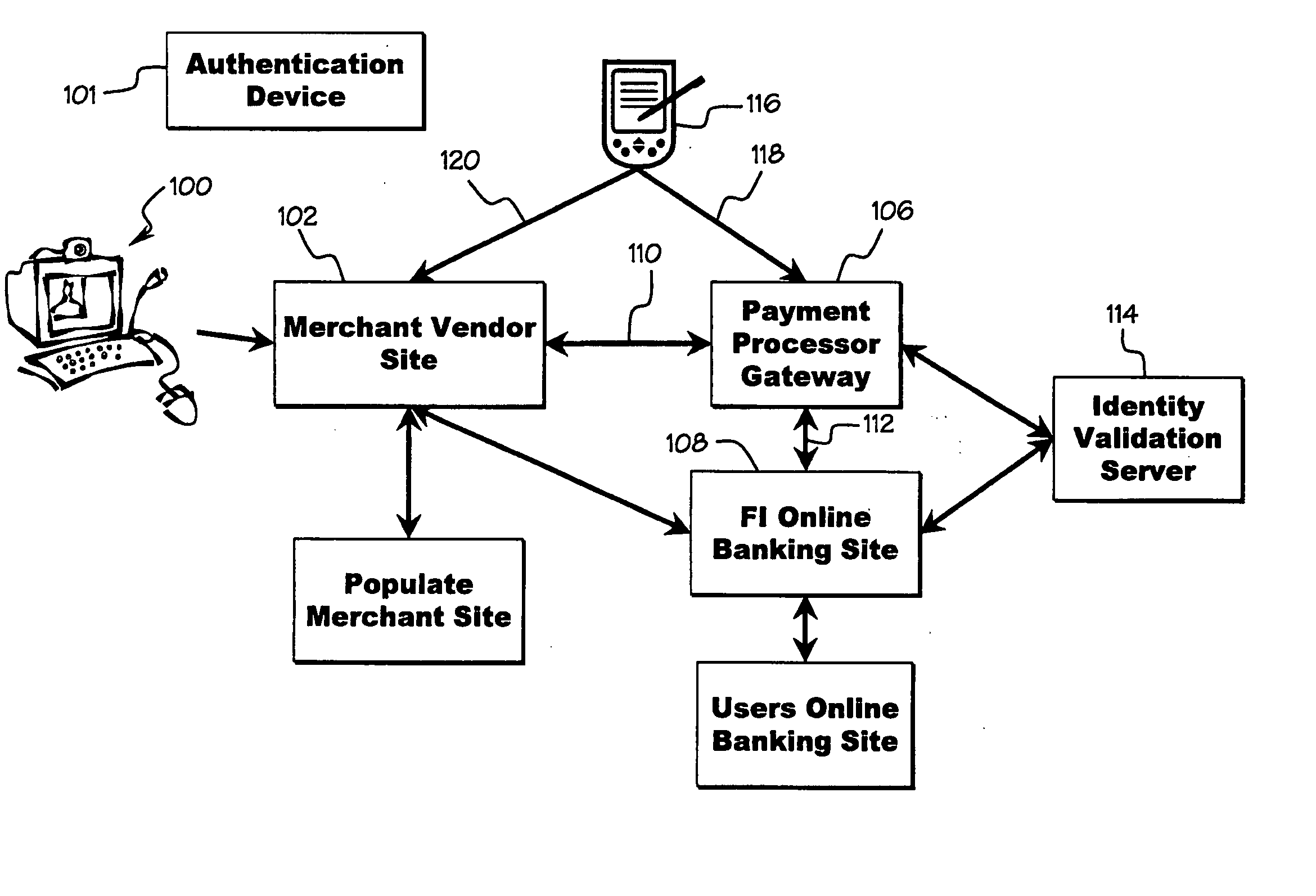

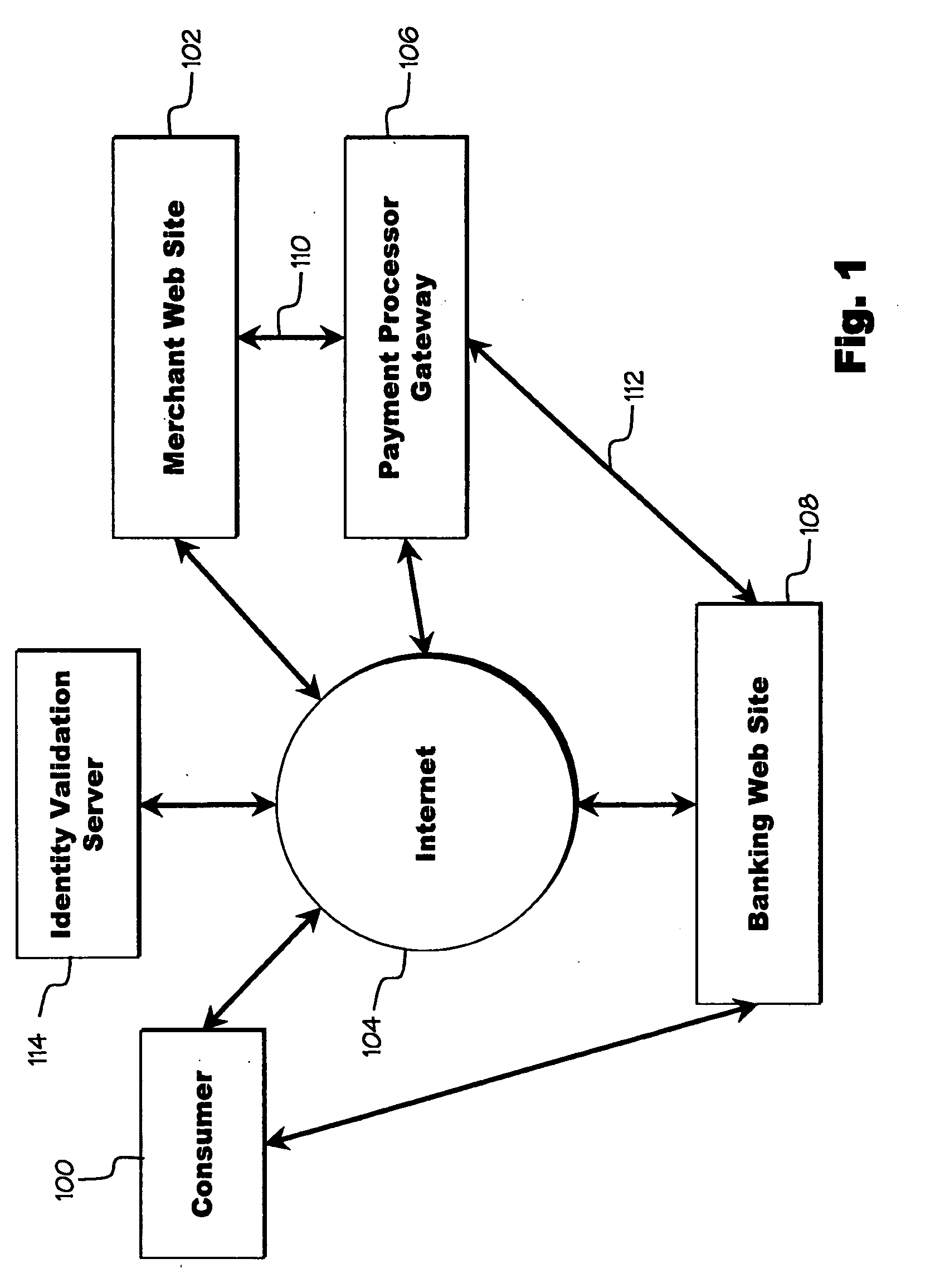

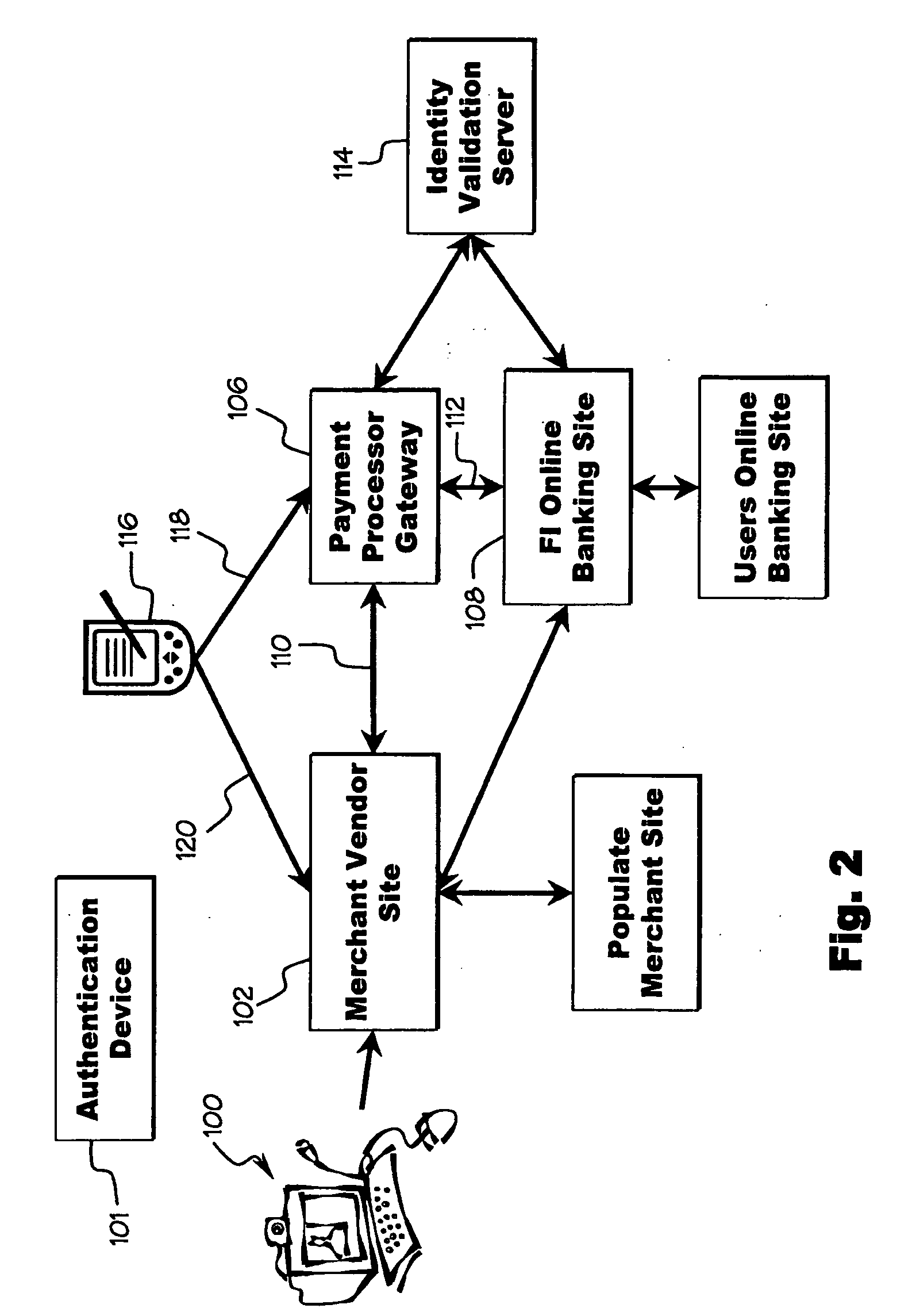

InactiveUS20060224508A1Reducing and eliminating riskPayment or settlement of transactions using the systemFinancePayment architectureUser identifierChallenge response

Discloses a payment transfer system used to transfer funds from a payer to a payee using an online payment processor gateway. The payment processor gateway is accessible by a payer over the internet from a merchant web site or by telephone contact using mobile SMS messaging or mobile, POTS or VoIP interactive voice response. The payer is authenticated to use the system by a challenge response process. The challenge response process may include a user identifier such as a card number and related password or PIN or the challenge response may include a scanned biometric parameter such as a fingerprint or retinal scan.

Owner:FIETZ GUY DAVID

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com