Patents

Literature

293 results about "Merchant services" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

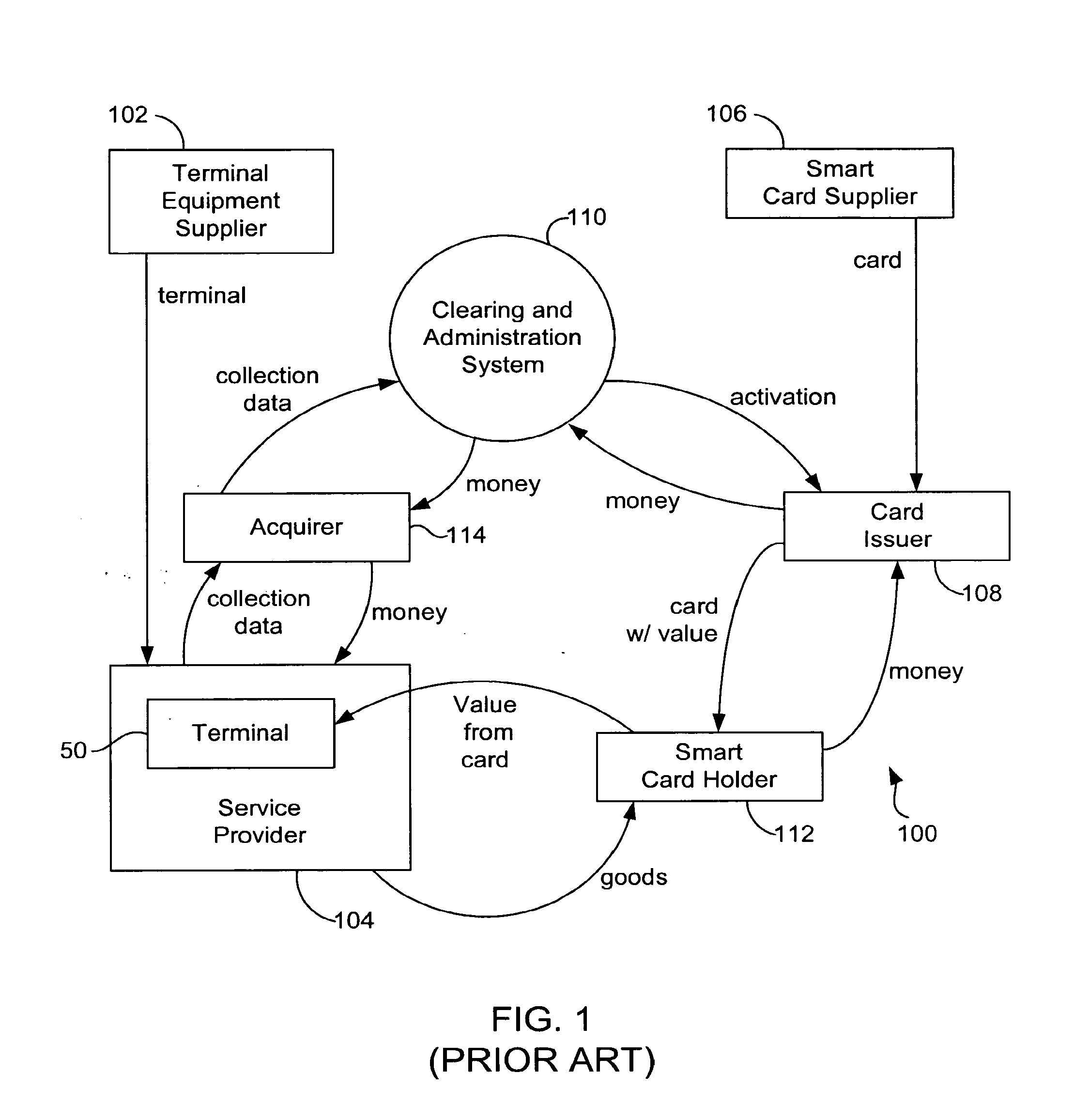

Merchant services is a broad category of financial services intended for use by businesses. In its most specific use, it usually refers to merchant processing services that enables a business to accept a transaction payment through a secure (encrypted) channel using the customer's credit card or debit card or NFC/RFID enabled device.

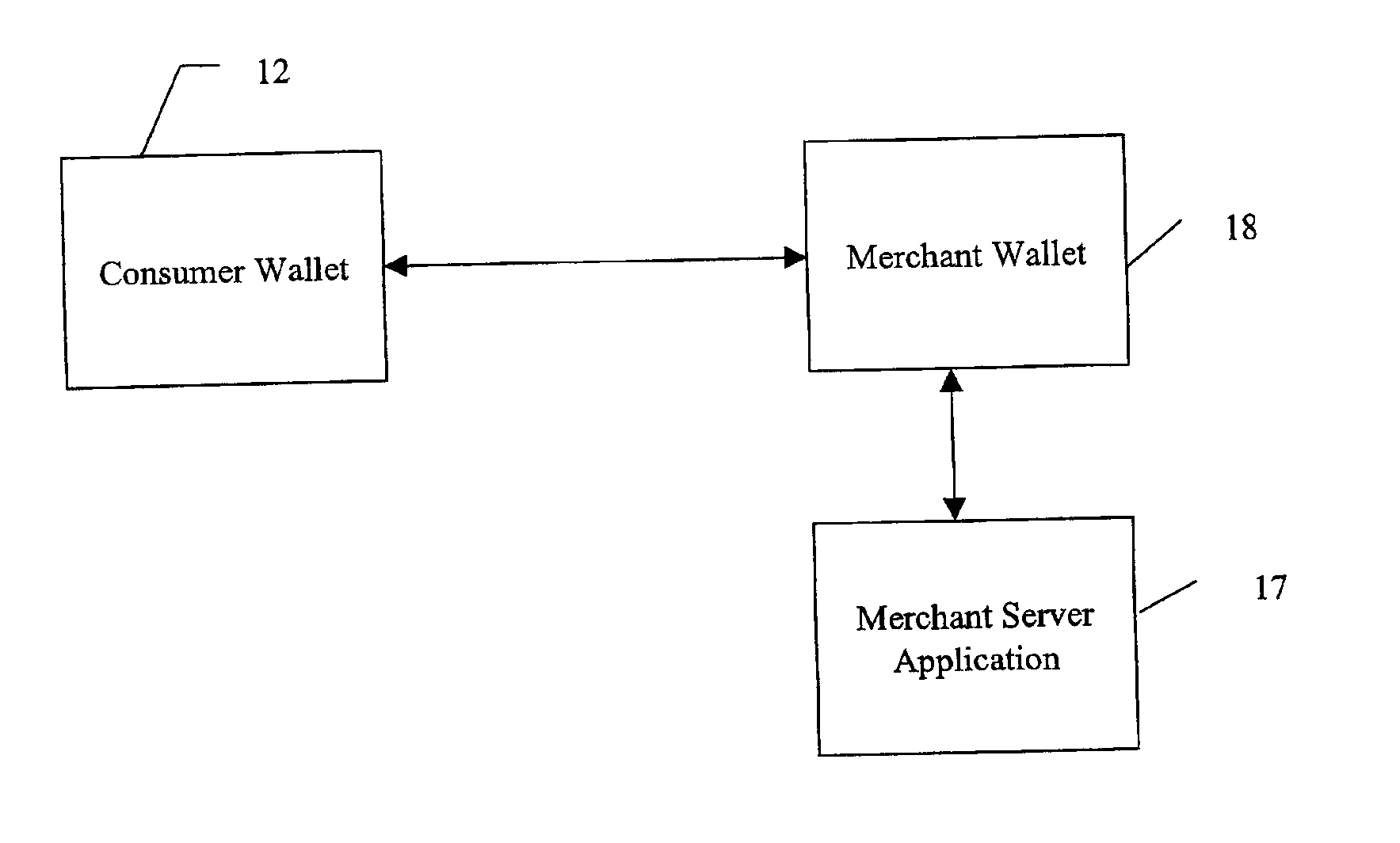

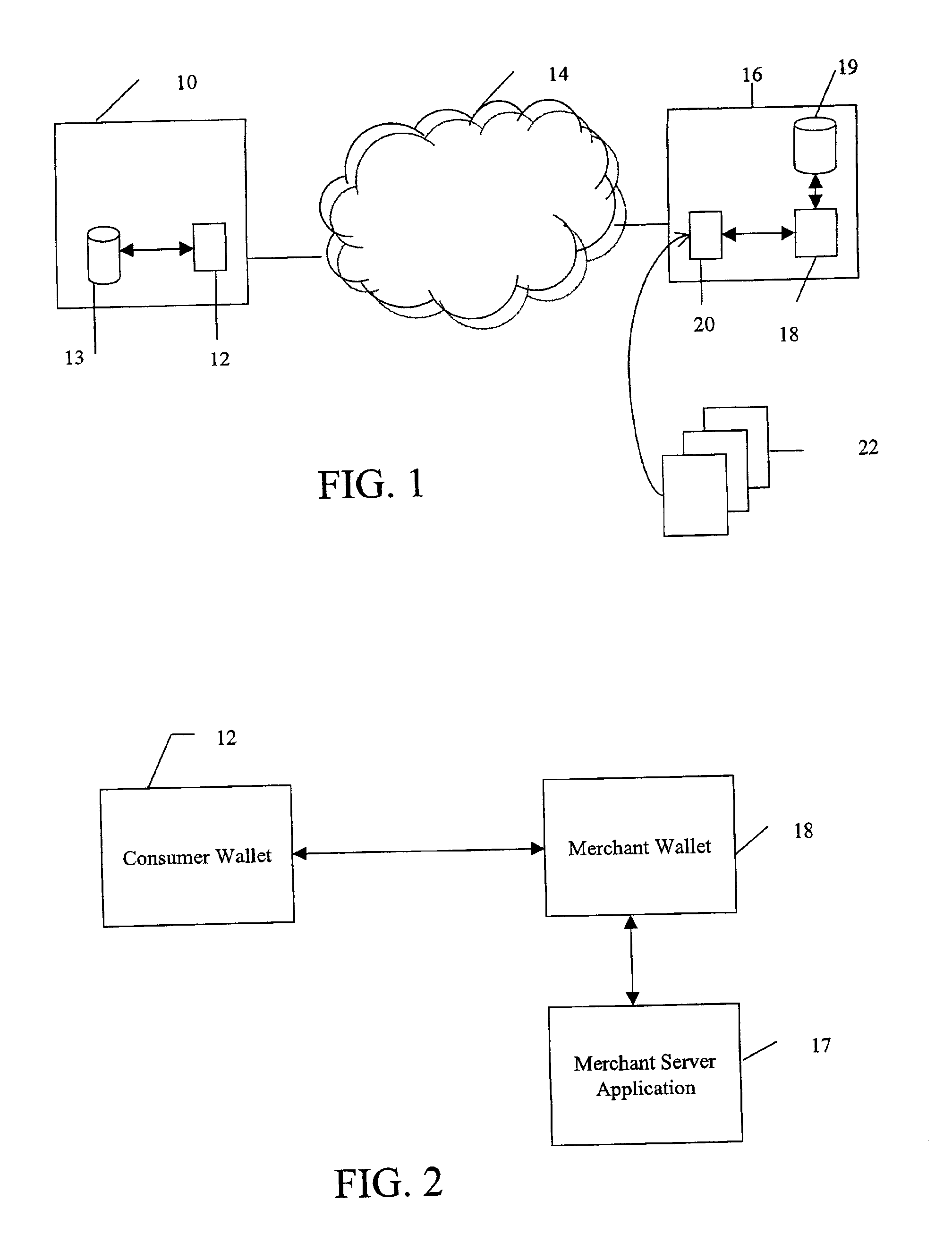

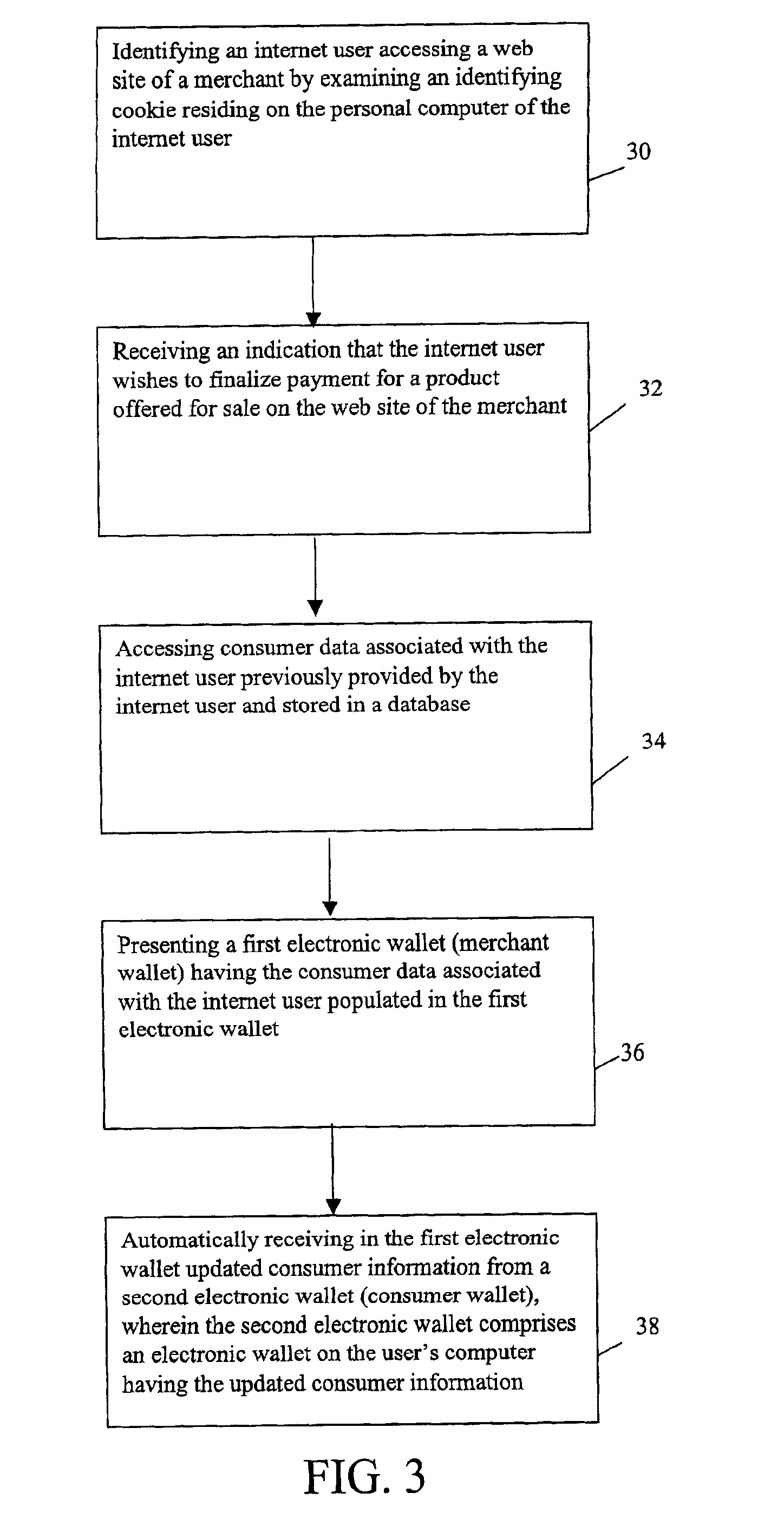

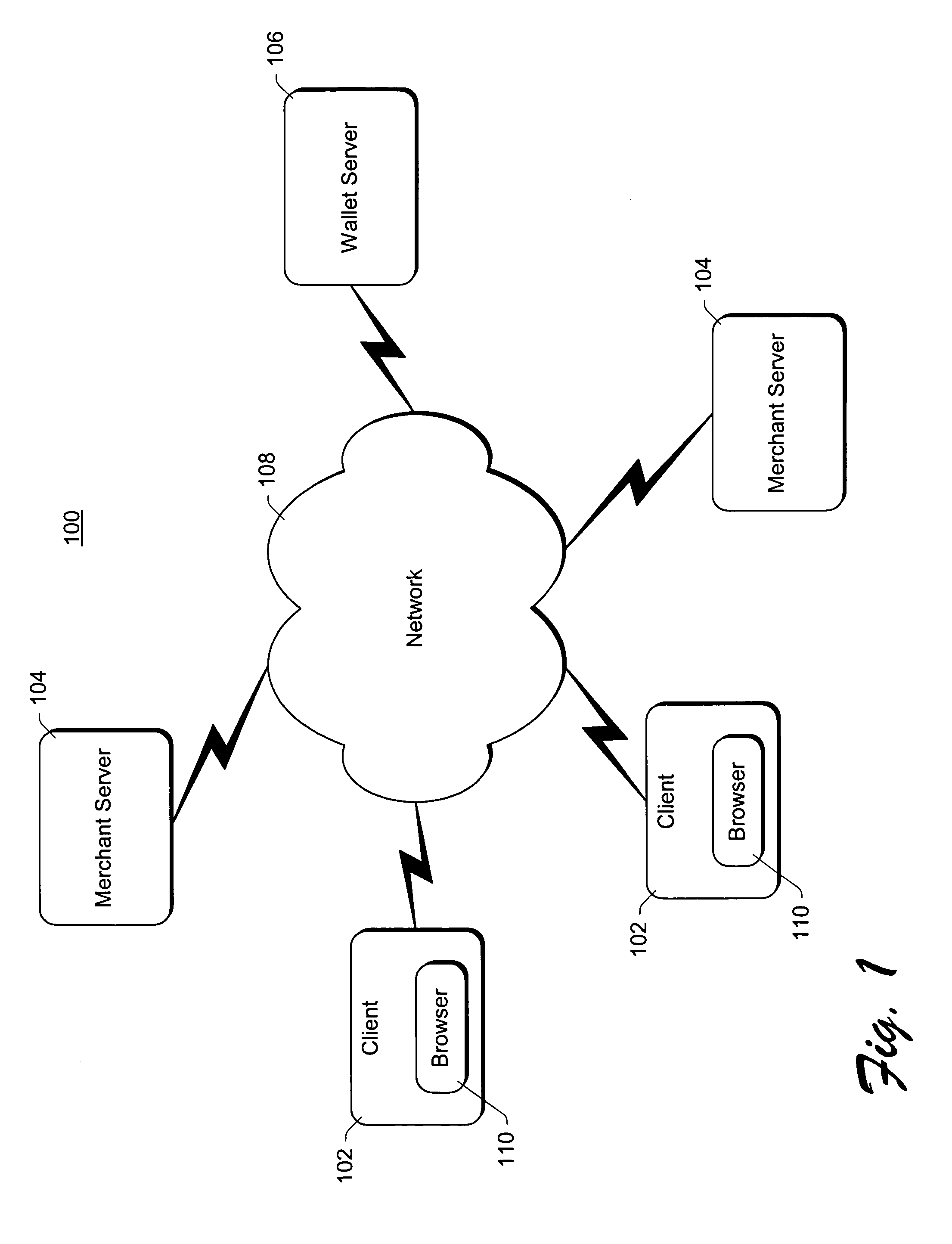

System and method for use of distributed electronic wallets

InactiveUS6873974B1Avoid burdenImprove efficiencyComplete banking machinesFinanceMerchant servicesCredit card

Methods and systems whereby two electronic wallets communicate and exchange information. In one such system, a consumer's personal electronic wallet communicates with the exclusive or preferred wallet of a web merchant. In one such system, an internet consumer registers with a web merchant's exclusive or preferred electronic wallet (“merchant wallet”) and provides consumer information (e.g., credit card number, mailing address, and other information) to the merchant wallet, which is stored by the merchant wallet in a database on the merchant server. Such information may be automatically populated by the consumer's personal electronic wallet. The consumer maintains current consumer information in a consumer electronic wallet on the consumer's personal computer. When the consumer visits the merchant site again, and orders goods or services, the merchant's preferred wallet can be automatically updated by the consumer's electronic wallet if any of the data in the merchant's wallet has changed. For example, the consumer wallet examines the information in the merchant wallet to determine if the information in the merchant wallet conforms to the current information in the consumer wallet. If the information does not conform, the consumer wallet communicates the current consumer information to the merchant wallet.

Owner:CITIBANK

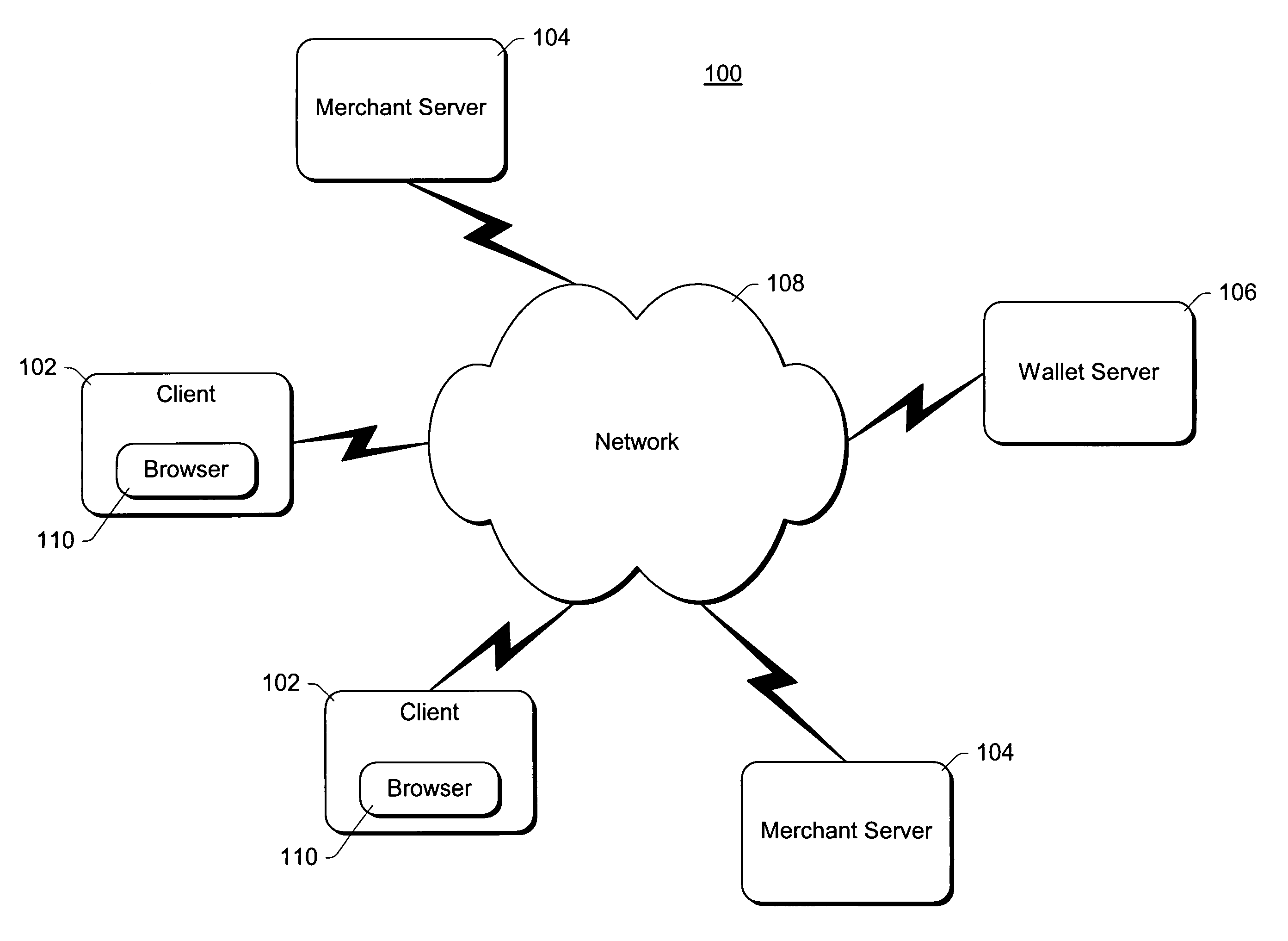

Integrating payment accounts and an electronic wallet

ActiveUS7155411B1Reduce amountReduce the amount requiredFinanceBuying/selling/leasing transactionsElectronic purseDatabase

An electronic wallet including is made available to a user and is capable of storing a wide variety of different types of accounts (including both payment accounts and traditional credit card accounts). An identification of the different accounts corresponding to a user is displayed to the user and the user is allowed to manipulate these accounts. The electronic wallet also allows the user to combine funds from multiple different accounts into a single account. This combination allows the interface on a merchant server to be designed to accommodate a single account without concern for what types of accounts a user may wish to combine. Furthermore, in accordance with one aspect, when the user is purchasing goods and / or services from a merchant on-line, only those accounts that are useable at the merchant are presented as being available to the user.

Owner:MICROSOFT TECH LICENSING LLC

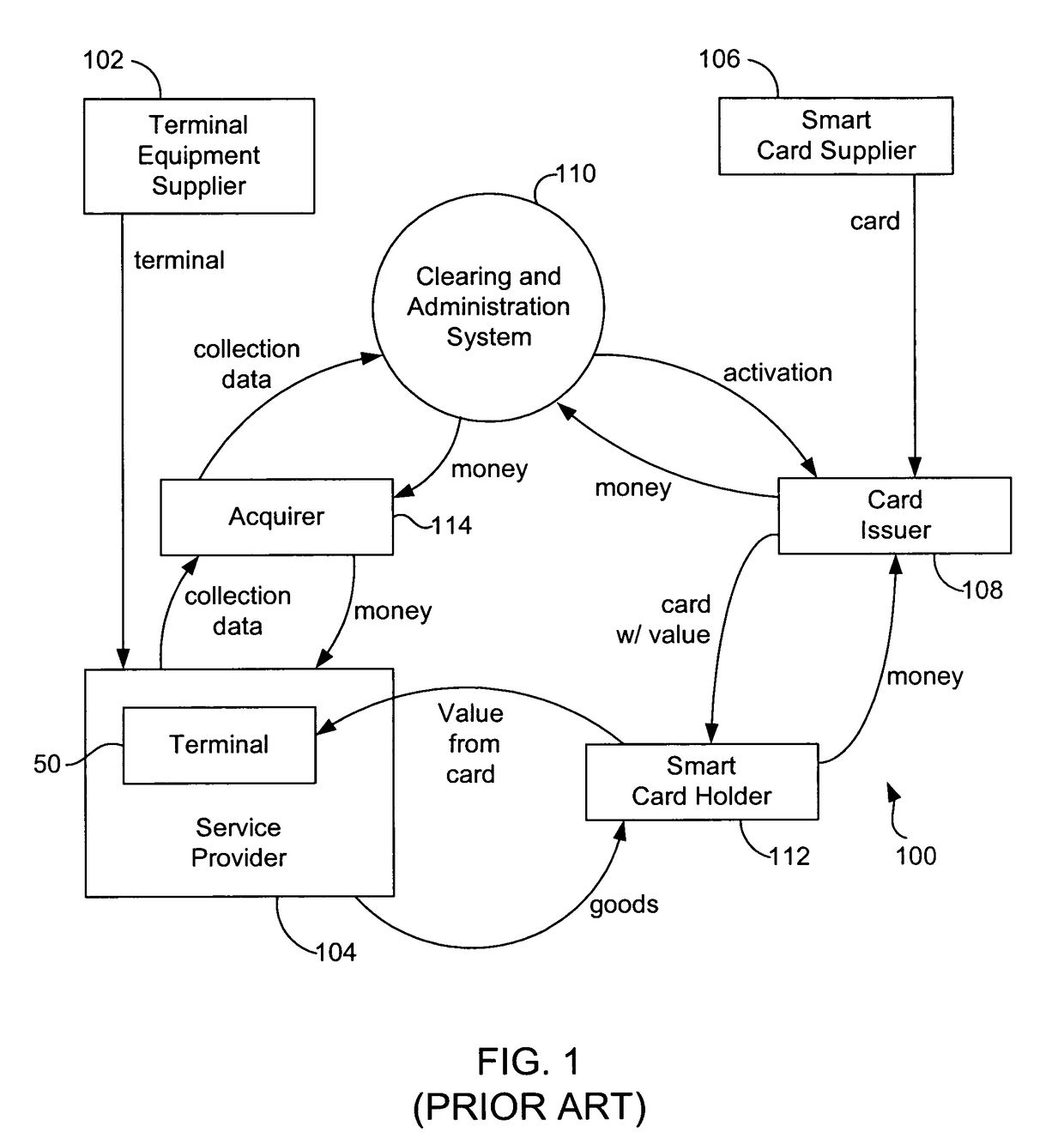

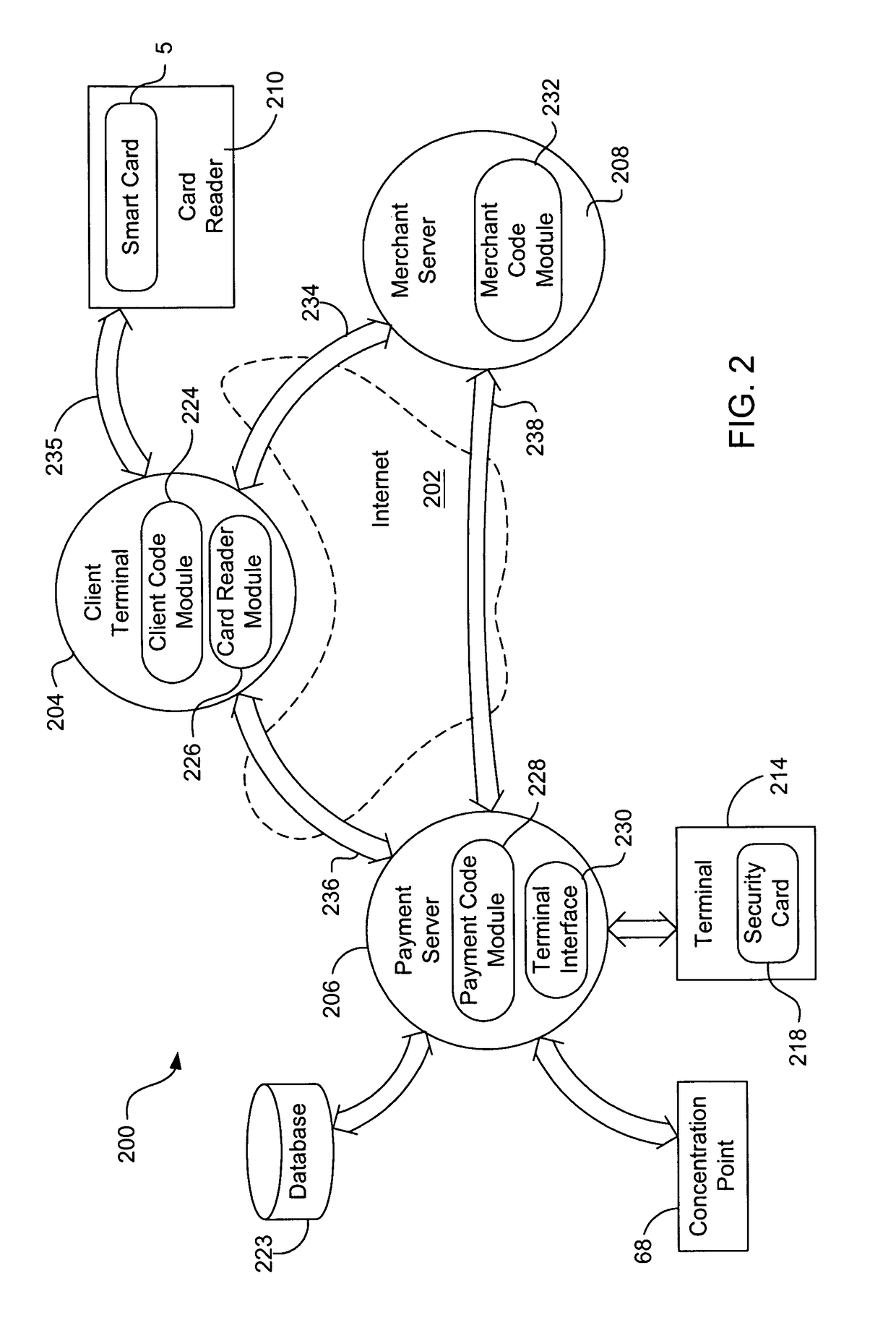

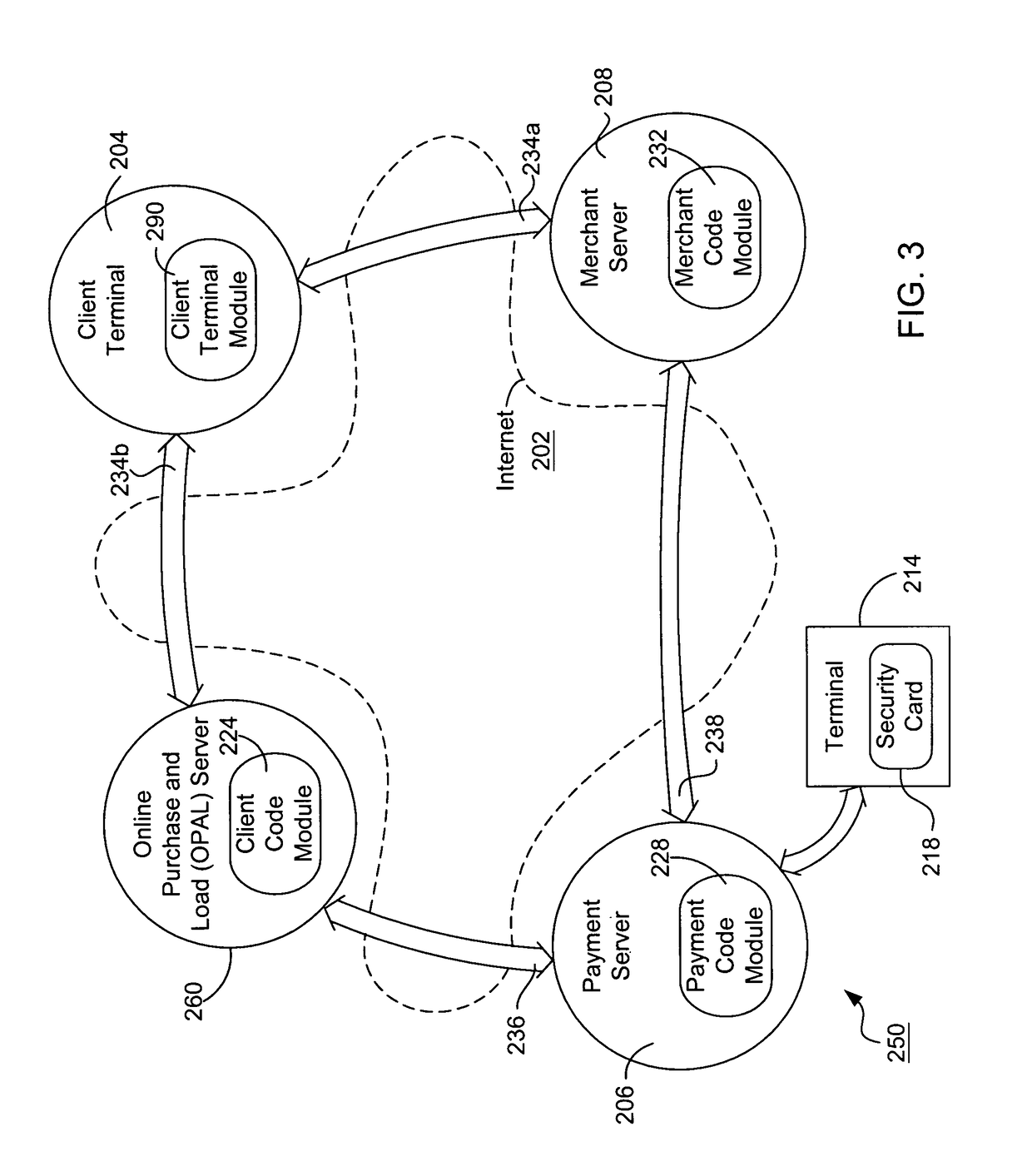

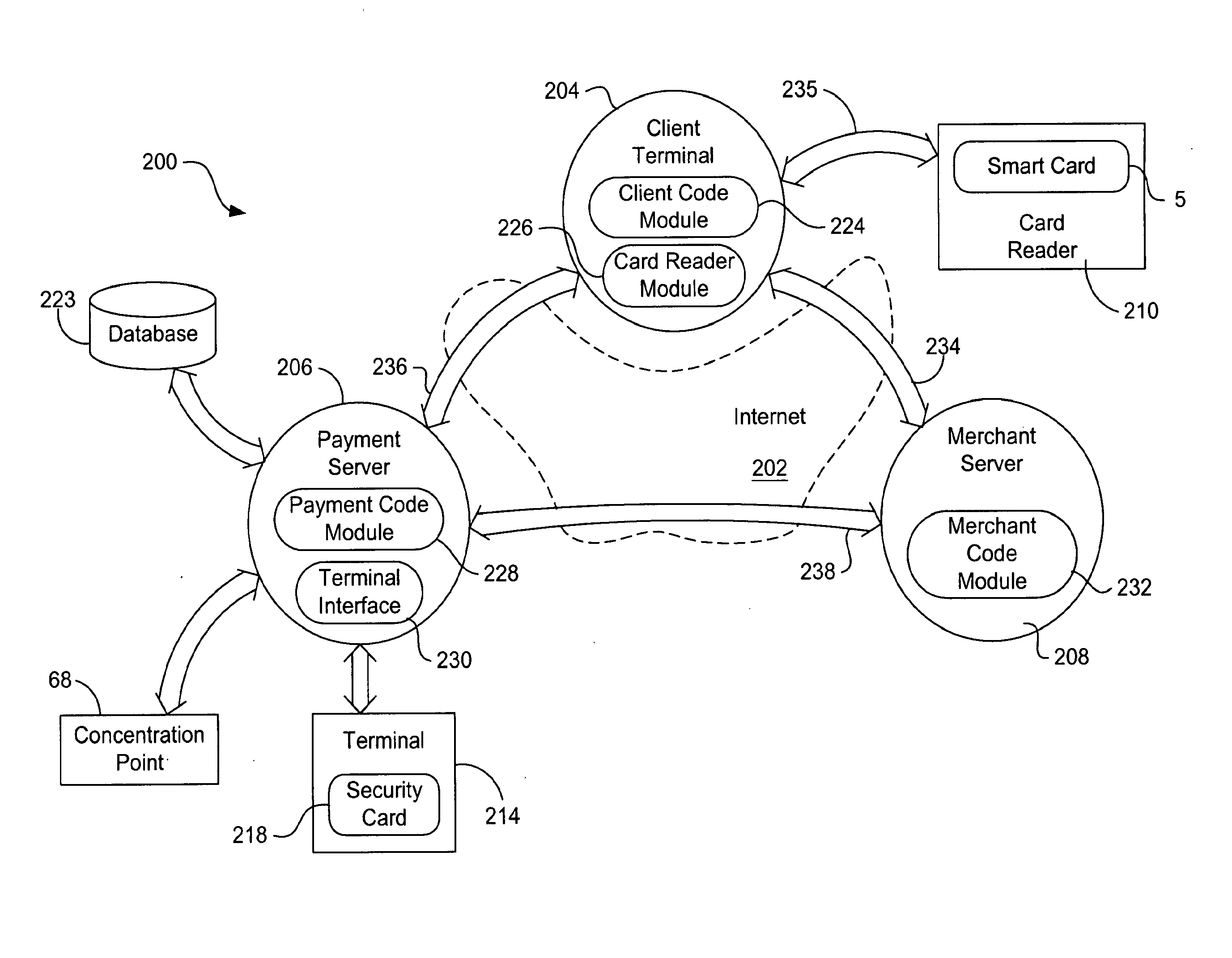

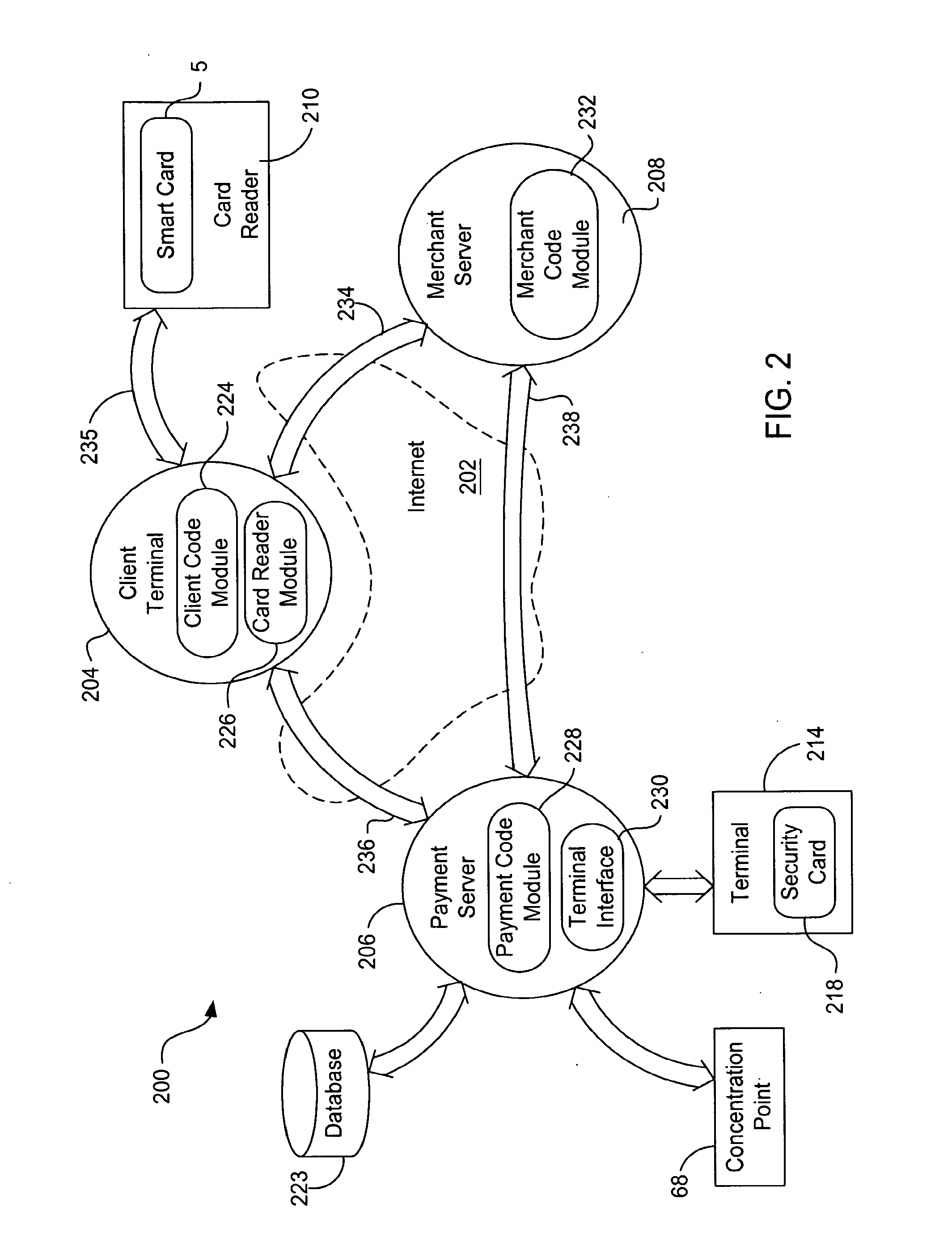

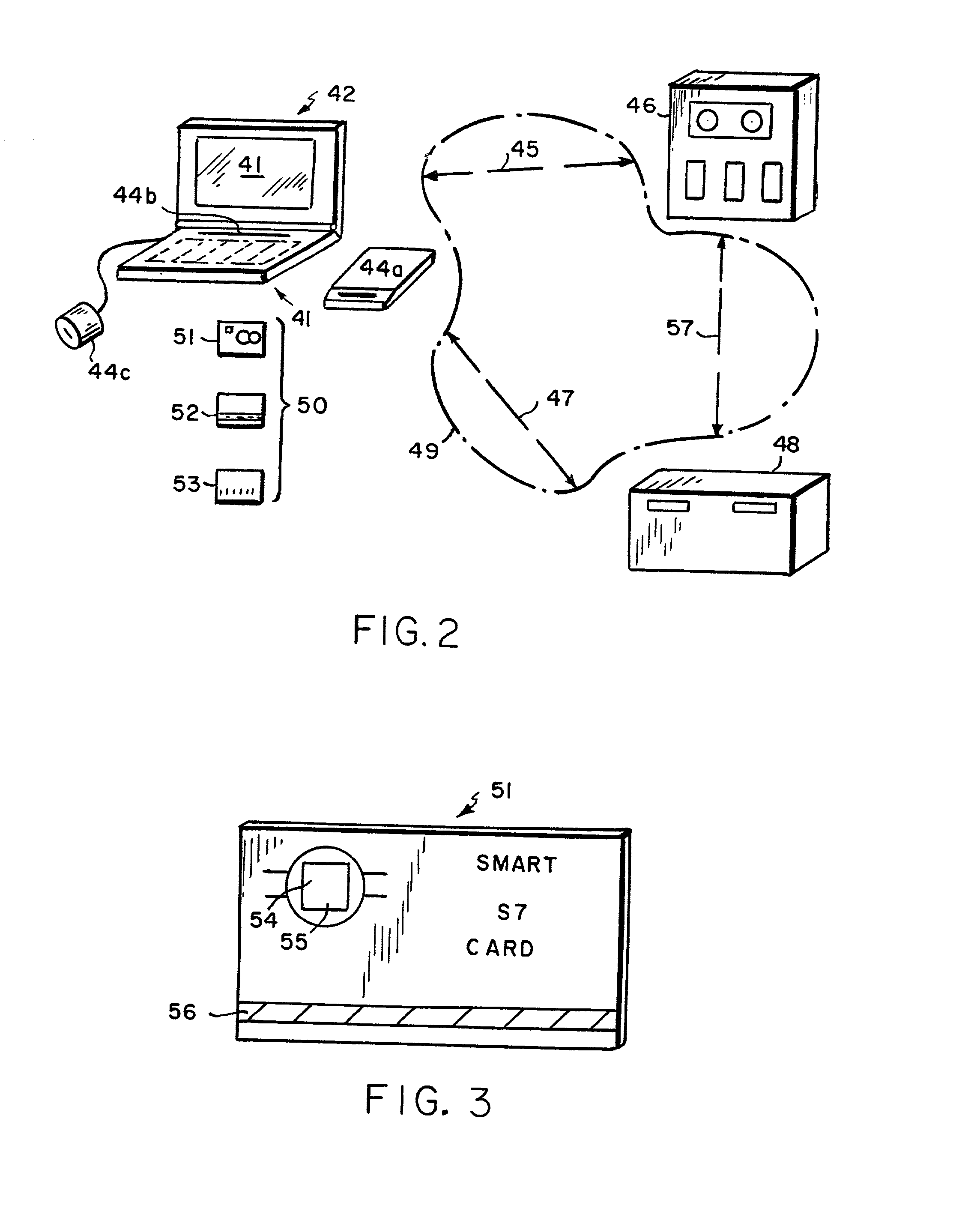

Internet payment, authentication and loading system using virtual smart card

InactiveUS7908216B1Advantageous for small dollar amount transactionMinimal timeFinancePayment circuitsMerchant servicesPayment

A system loads, authenticates and uses a virtual smart card for payment of goods and / or services purchased on-line over the Internet. An online purchase and load (OPAL) server includes a virtual smart card data base that has a record of information for each smart card that it represents for a user at the behest of an issuer. The server includes a smart card emulator that emulates a smart card by using the card data base and a hardware security module. The emulator interacts with a pseudo card reader module in the server that imitates a physical card reader. The server also includes a client code module that interacts with the pseudo card reader and a remote payment or load server. A pass-through client terminal presents a user interface and passes information between the OPAL server and a merchant server, and between the OPAL server and a bank server. The Internet provides the routing functionality between the client terminal and the various servers. A merchant advertises goods on a web site. A user uses the client terminal to purchase goods and / or services from the remote merchant server. The payment server processes, confirms and replies to the merchant server. The payment server is also used to authenticate the holder of a virtual card who wishes to redeem loyalty points from a merchant. To load value, the client terminal requests a load from a user account at the bank server. The load server processes, confirms and replies to the bank server.

Owner:VISA INT SERVICE ASSOC

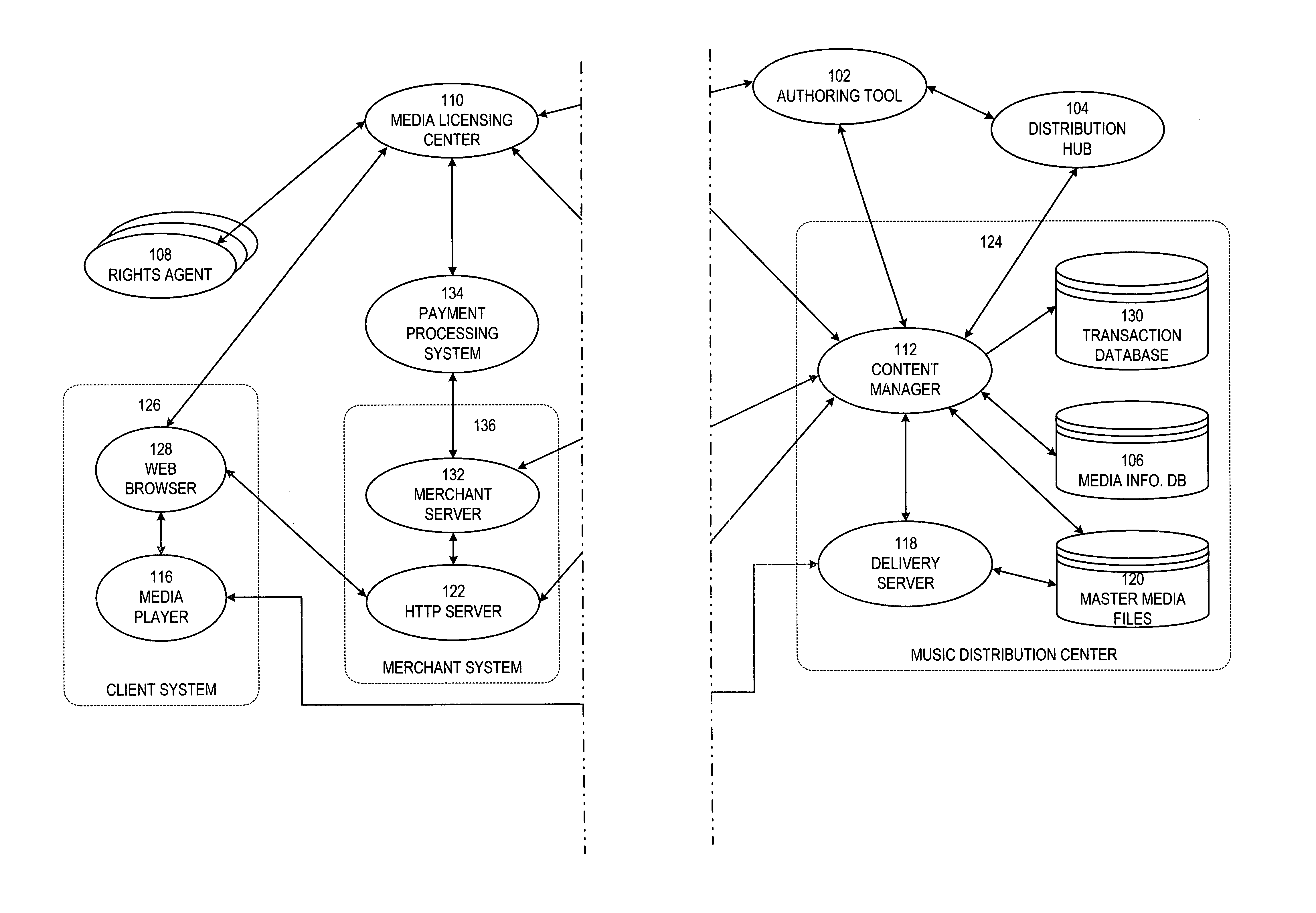

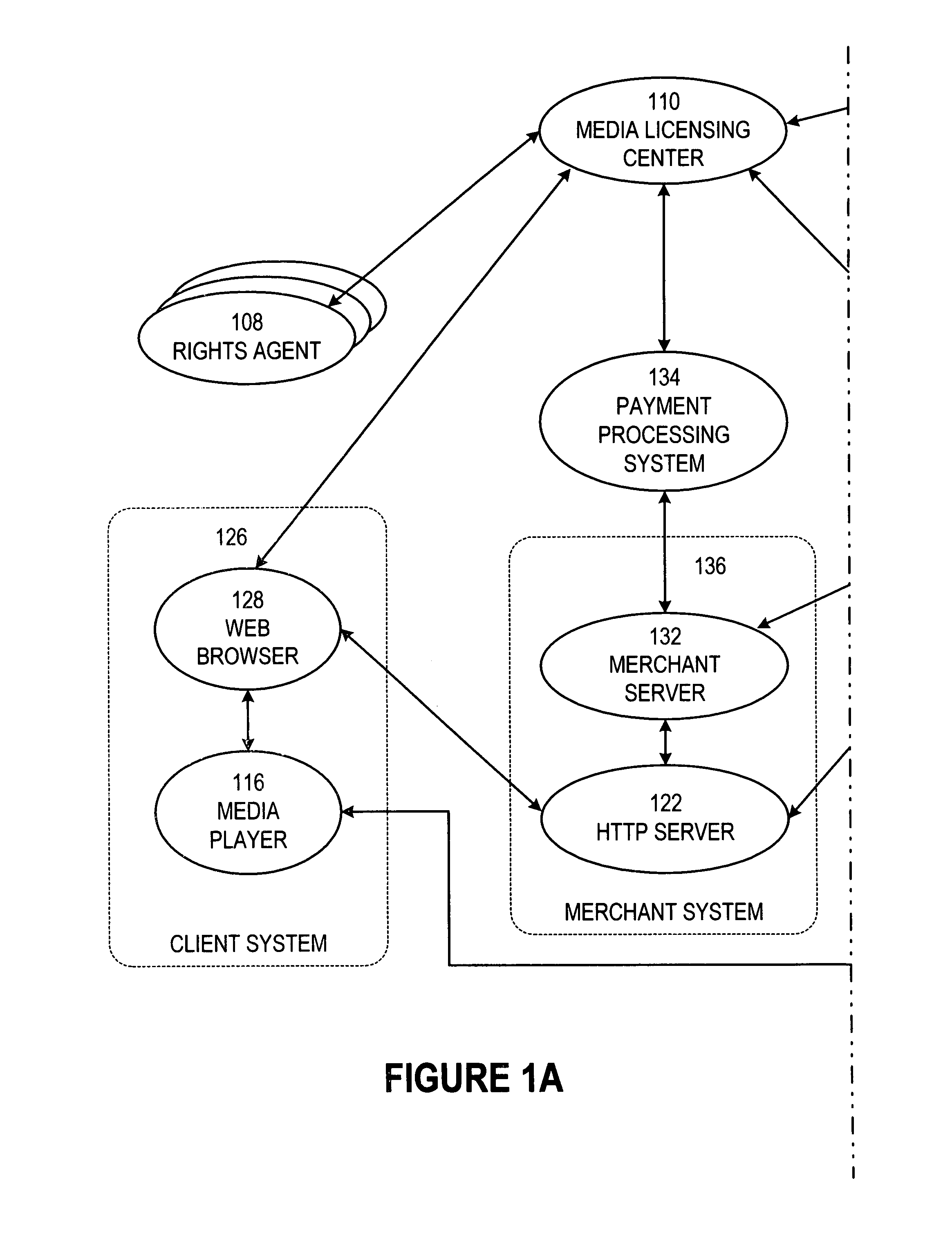

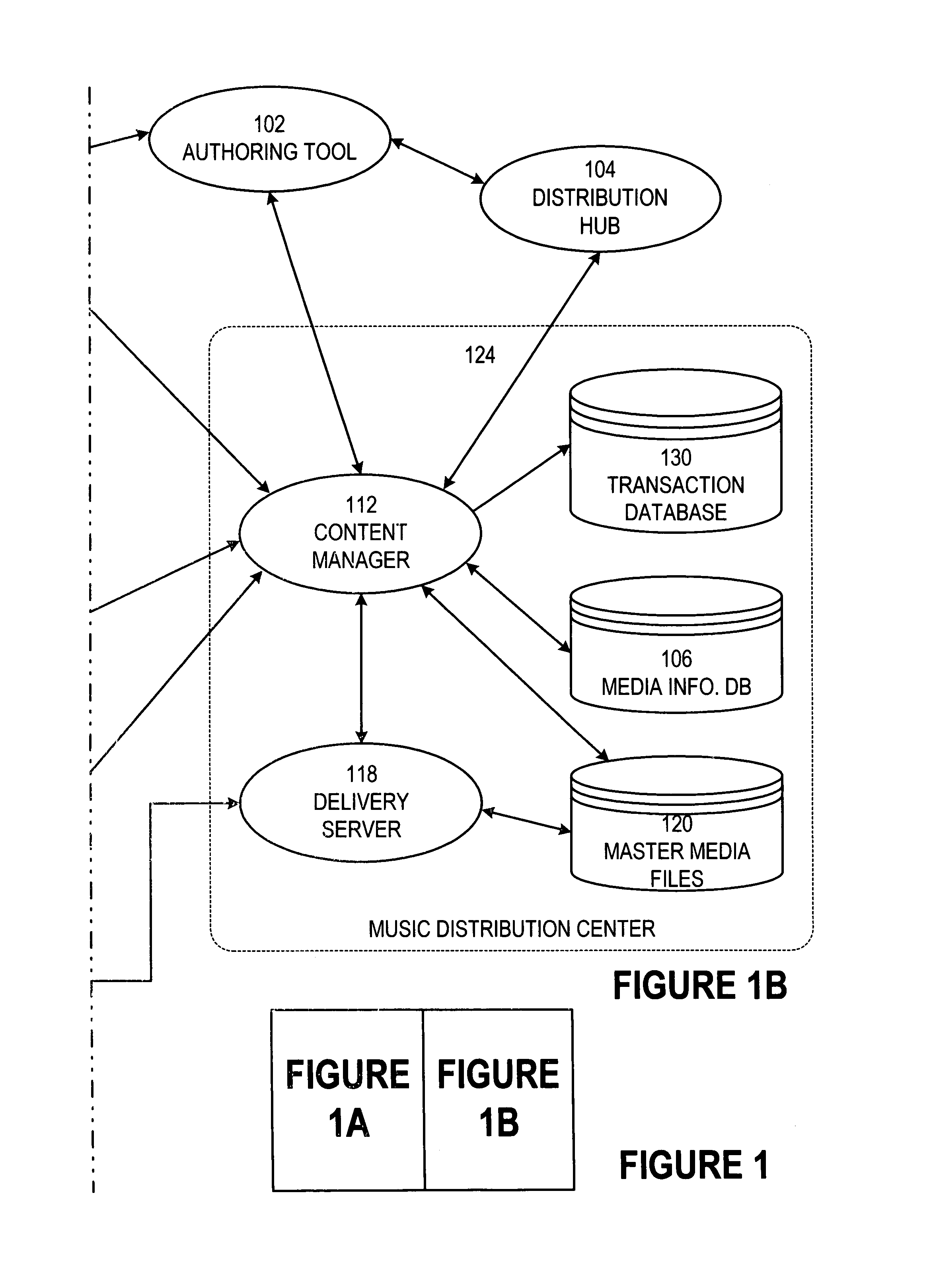

Secure online music distribution system

InactiveUS7263497B1Flexibility and ease of useGood flexibilityComputer security arrangementsPayment architectureContent managementInformation data

A secure music distribution system securely distributes digital products such as music, video, and / or computer software along with related media over a public telecommunications network, such as the Internet, employing a client-server architecture. The digital products are stored and controlled by a content manager computer system and are sold by separate merchant computer systems. The secure music distribution system includes a music distribution center which operates with any number of client systems and with any number of merchant systems. The music distribution center includes a content manager and at least one delivery server. The content manager maintains a media information database, a master media file system, and a transaction database. In addition, the music distribution center interfaces with a media licensing center, which in turn communicates with one or more distributed rights agent servers and the merchant servers. The merchant server executes in a merchant computer system, which also includes an HTTP (HyperText Transfer Protocol) server. The merchant servers interface with various payment processing systems. The client systems include a media player and a Web browser. Additional delivery servers and media licensing centers operate independently and externally to the music distribution center and interface with the music distribution center.

Owner:MICROSOFT TECH LICENSING LLC

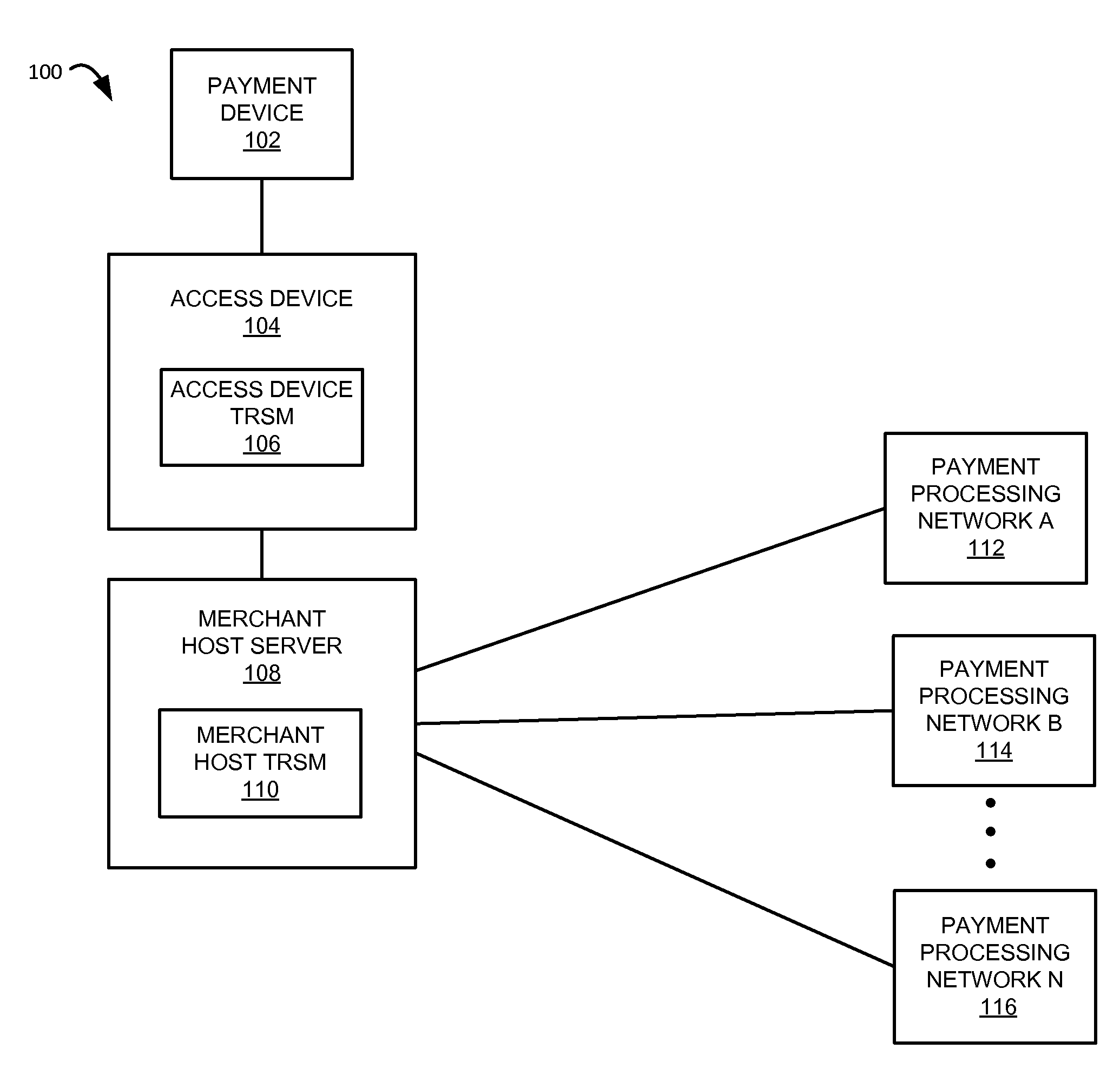

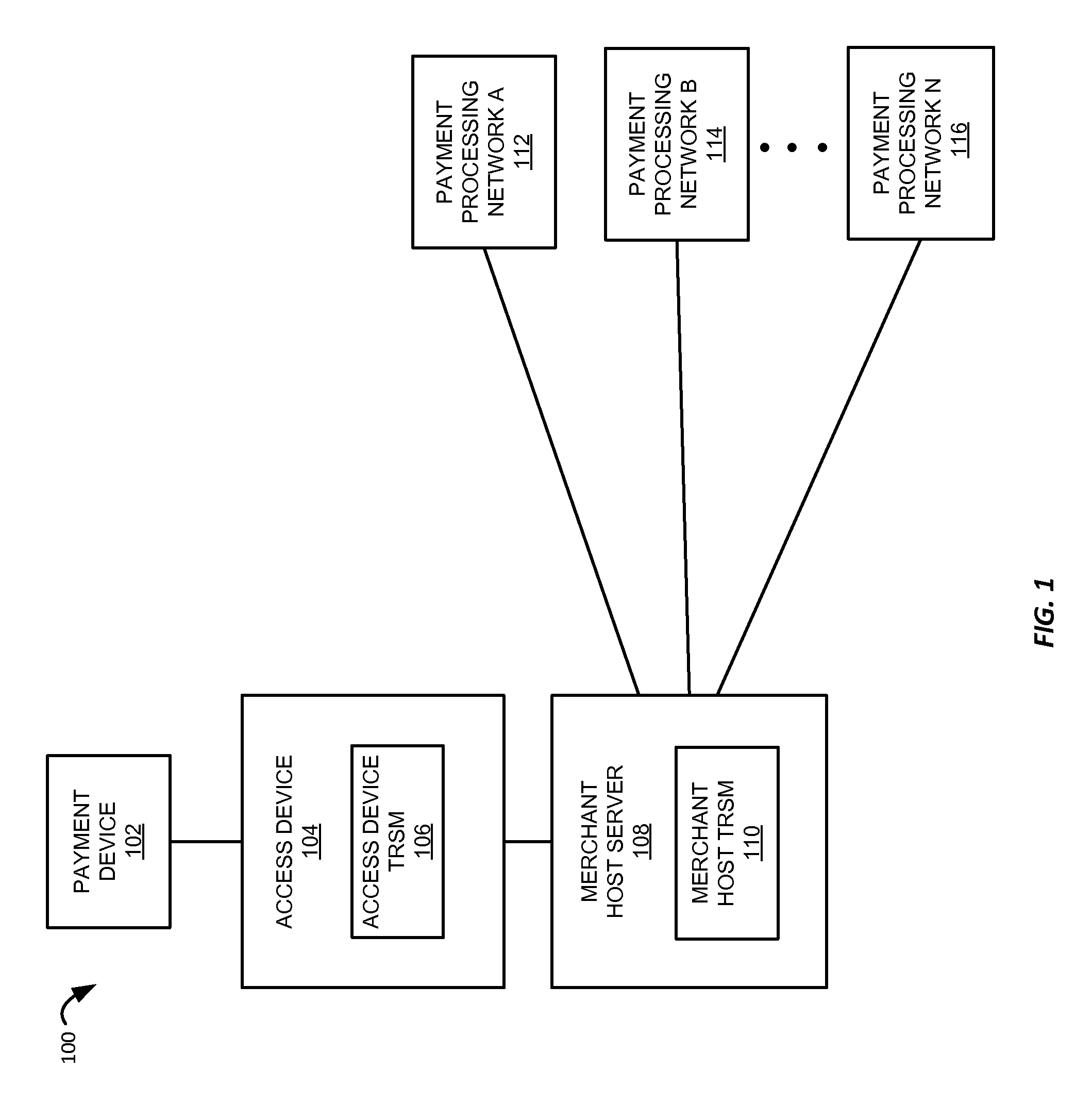

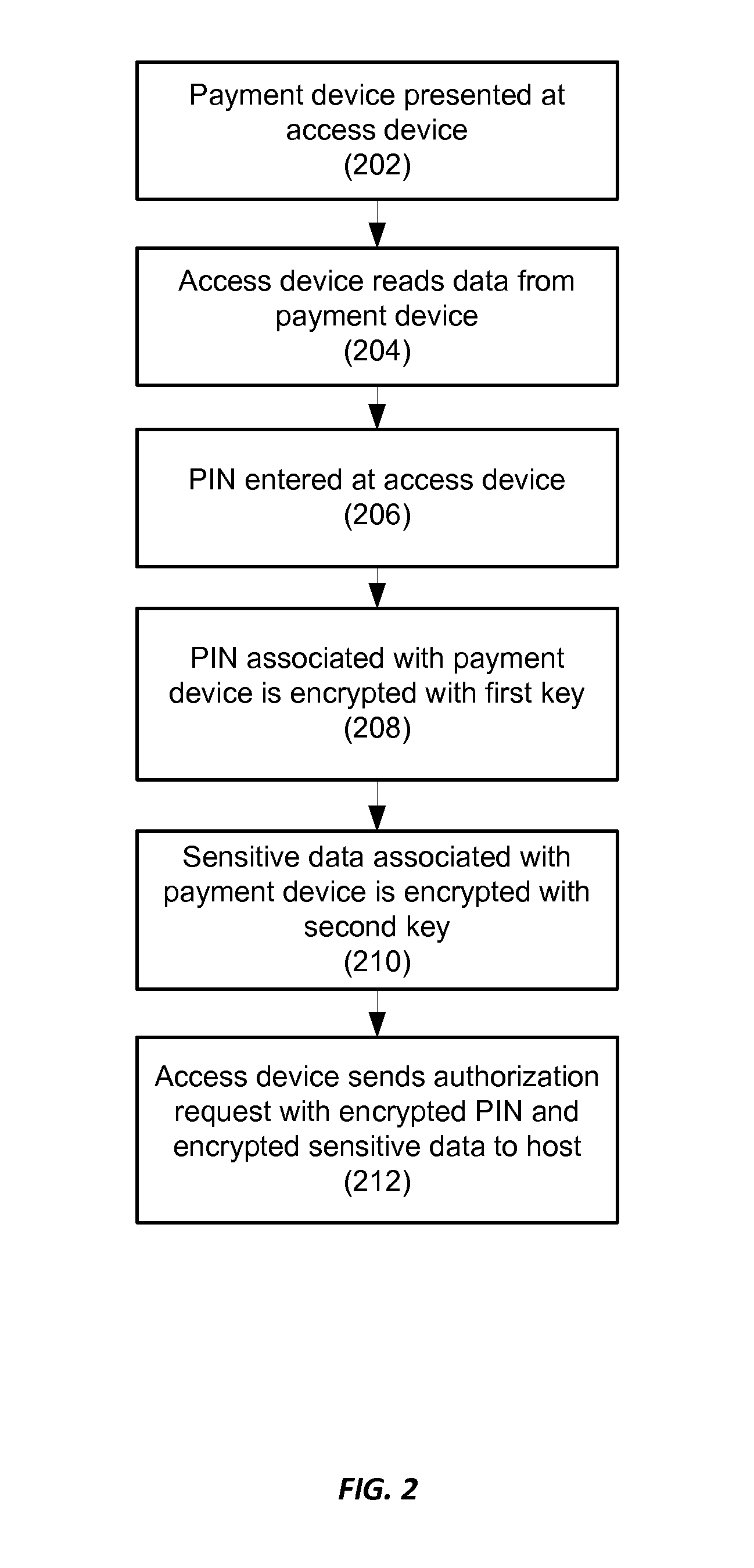

Data protection with translation

Systems and methods are disclosed in which data associated with a transaction are protected with encryption. At an access device, a PIN associated with a payment account may be encrypted with a first key derived from an initial key of the access device and sensitive data associated with the payment account may be encrypted with a second key derived from the initial key. At a secure module associated with a host server encrypted sensitive data of an authorization request message may be decrypted. The secure module associated with the host server can re-encrypt the sensitive data using a zone encryption key associated with a payment processing network. A translated authorization request message including the re-encrypted sensitive data can be transmitted by the merchant server to the payment processing network.

Owner:VISA INT SERVICE ASSOC

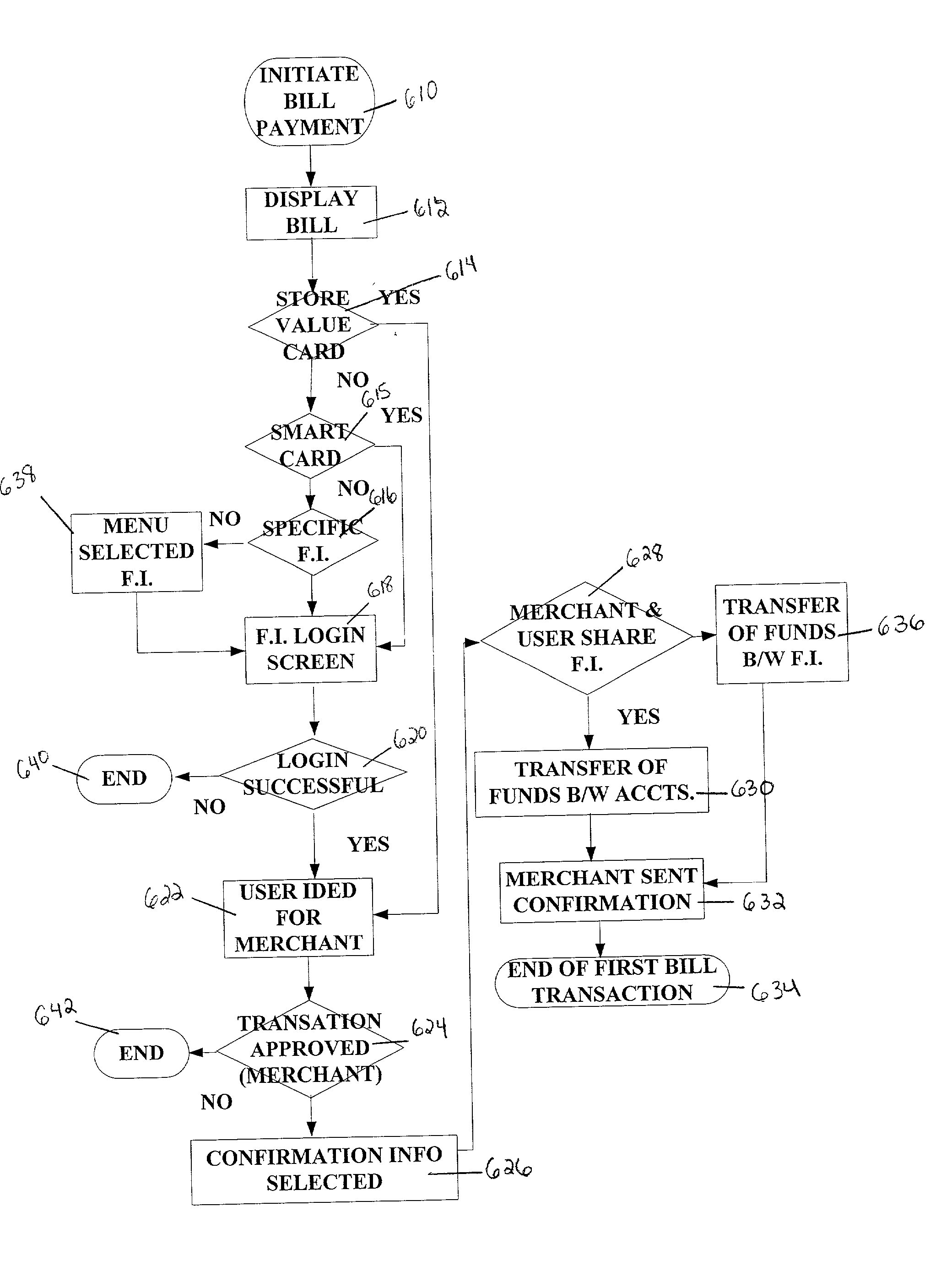

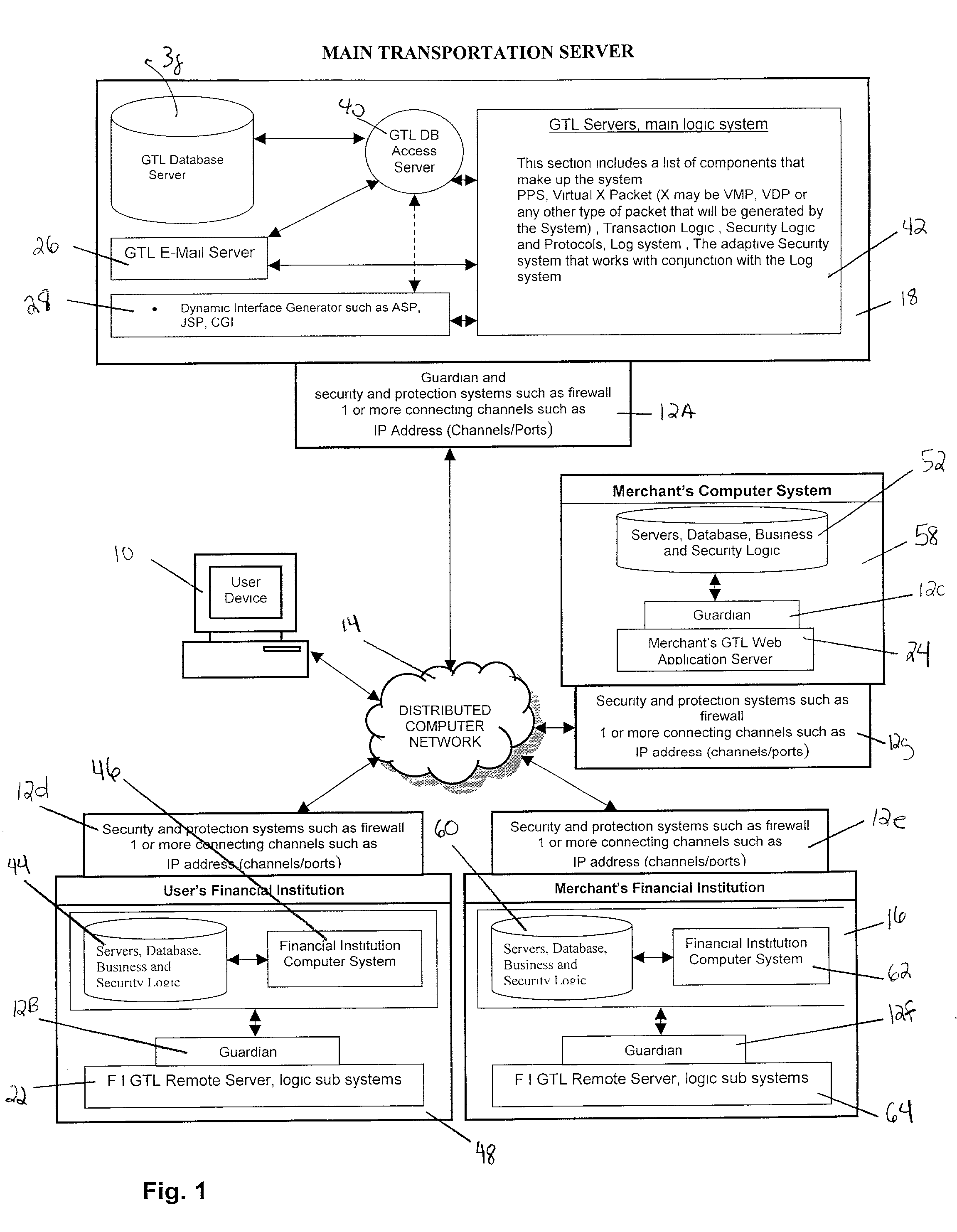

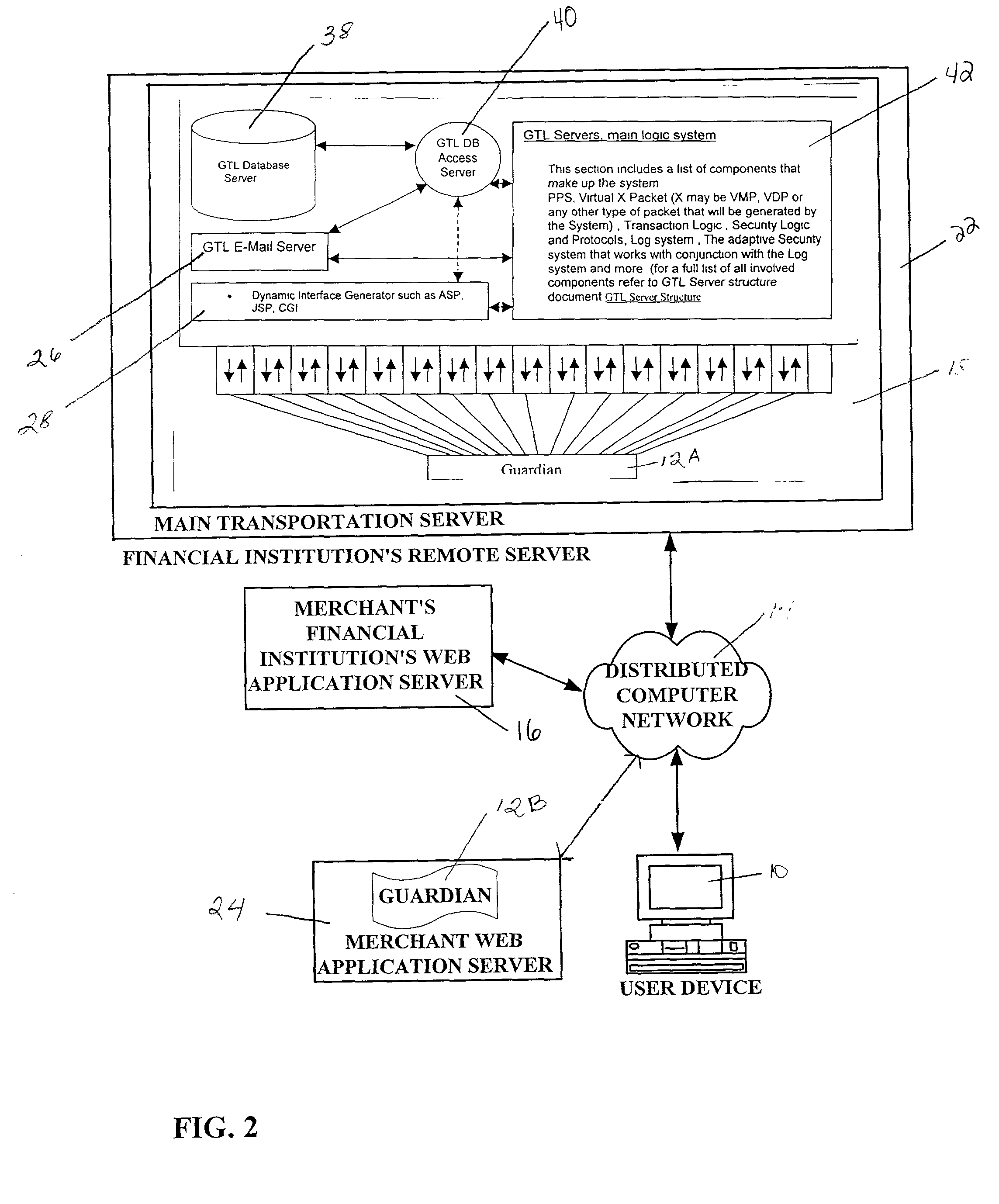

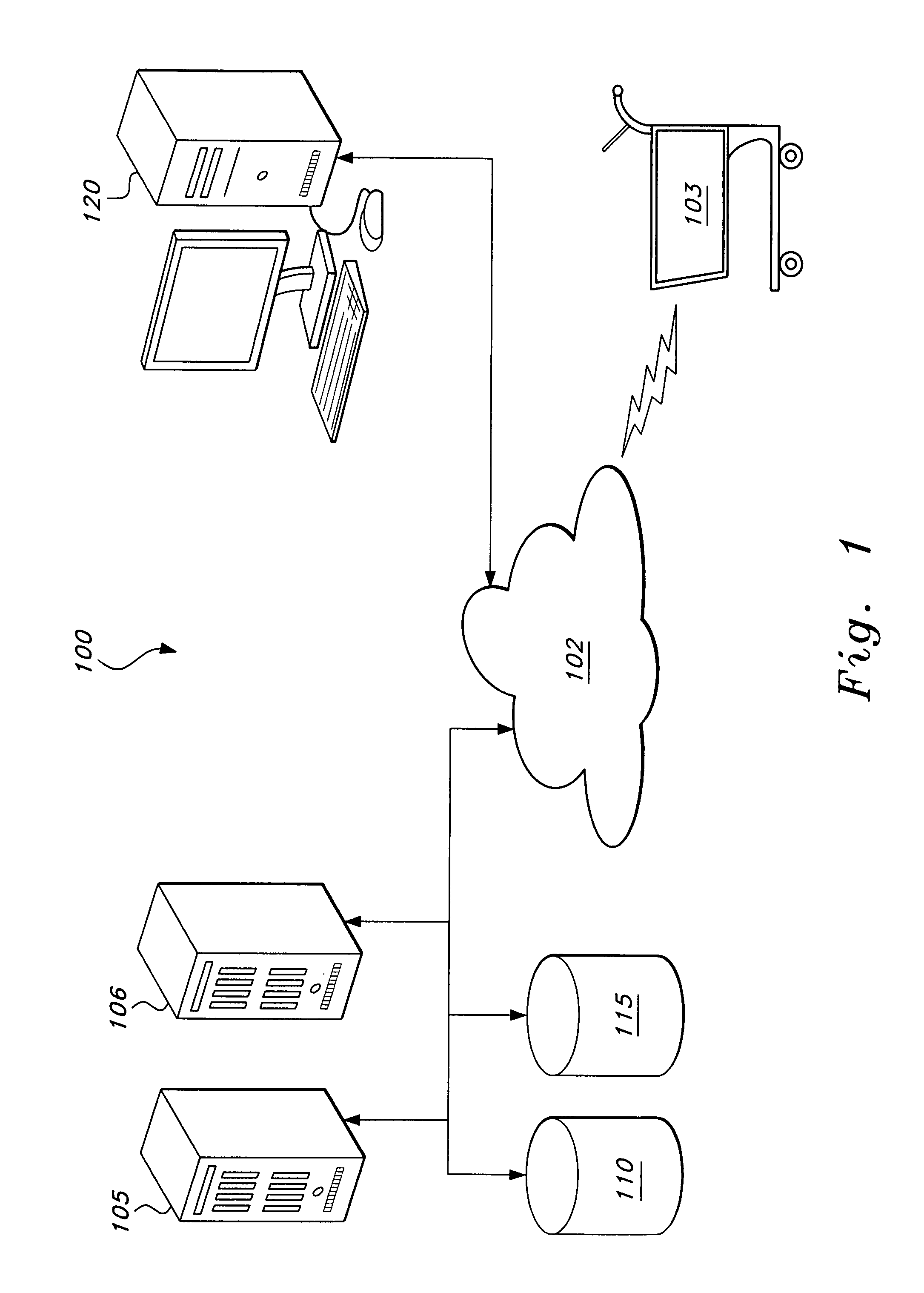

Transportation system for on-line transactions

InactiveUS20020052853A1Improve business satisfactionImprove operationFinancePayment circuitsMerchant servicesUser device

What is disclosed in this application is: an Internet payment system. An Internet payment system comprising a user device with a processor, Internet connection apparatus and an Internet browser. The Internet payment system also includes a participating merchant server supporting web pages on which product or service offerings are displayed in response to queries from the user device using the connections apparatus and browser. The merchant server interacting with the user device browser permits a user to select at least one offering and to indicate a method of payment, at least one method of payment being a transfer link. The Internet payment system also comprises a participating financial institution server maintained by a financial institution at which the user has a financial account. The server permits the user to gain direct access to his financial account. In addition, the Internet payment system includes a main transportation server to which both the user device and merchant server are connected in response to the user selecting the transfer link as the method of payment. The merchant server transmits information to the main transport server regarding payment required for the selected offering and the main transport server provides a selection of financial institutions from which the user can select an institute at which he has an account for payment for the offering. The main transport server transmits user inputs directly to the financial institution server to authorize payment to the merchant for the offering without storing the inputs.

Owner:MUNOZ FERNANDO

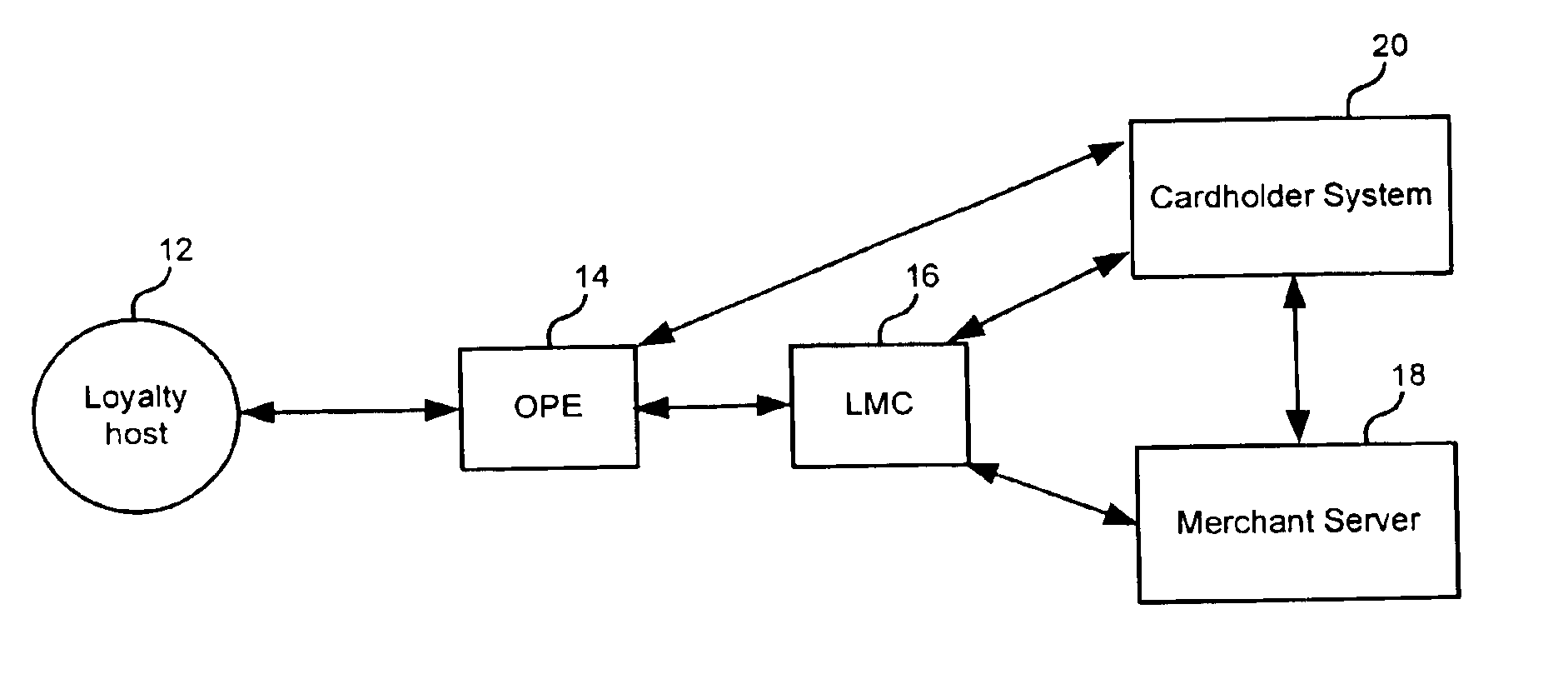

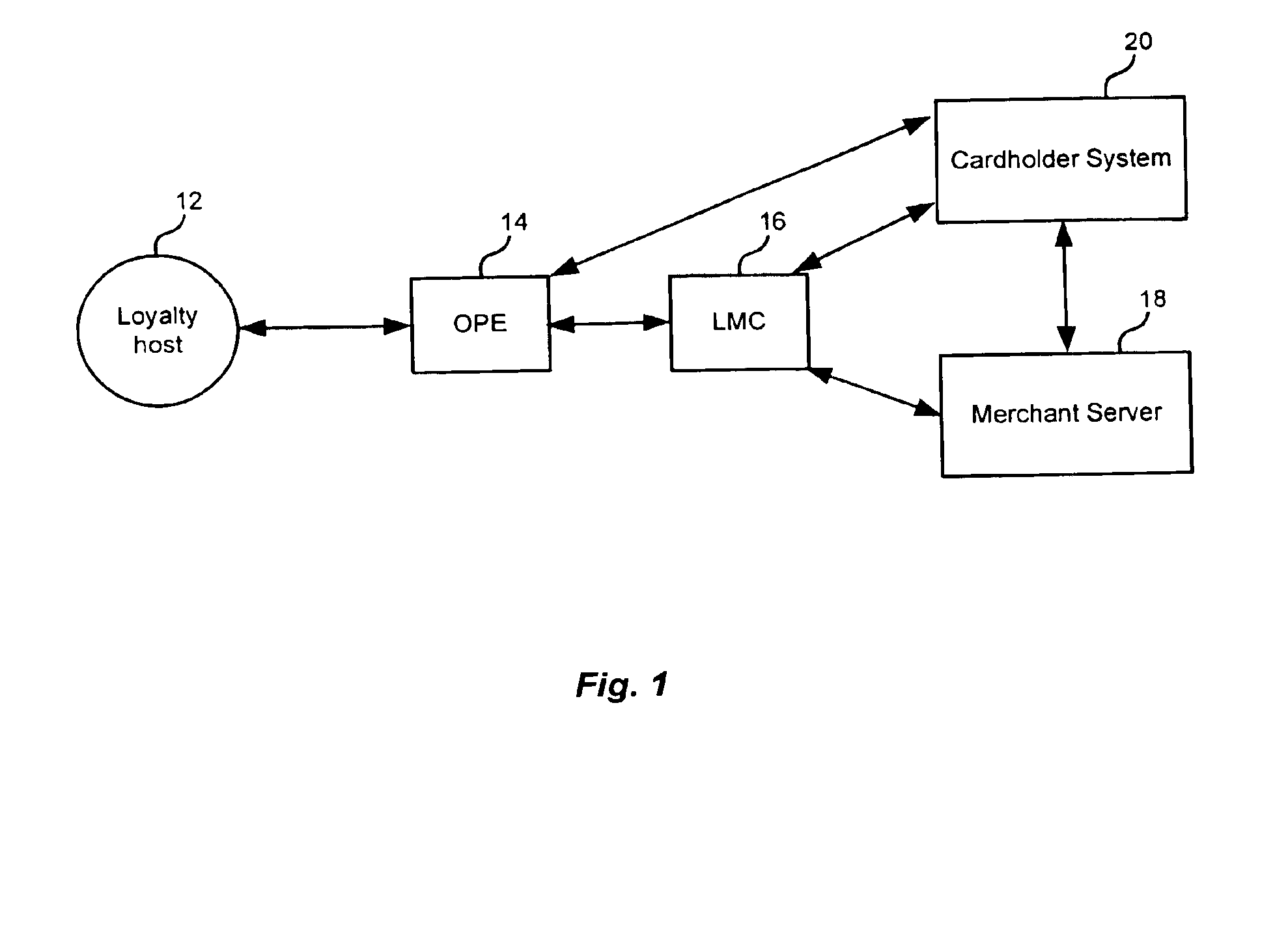

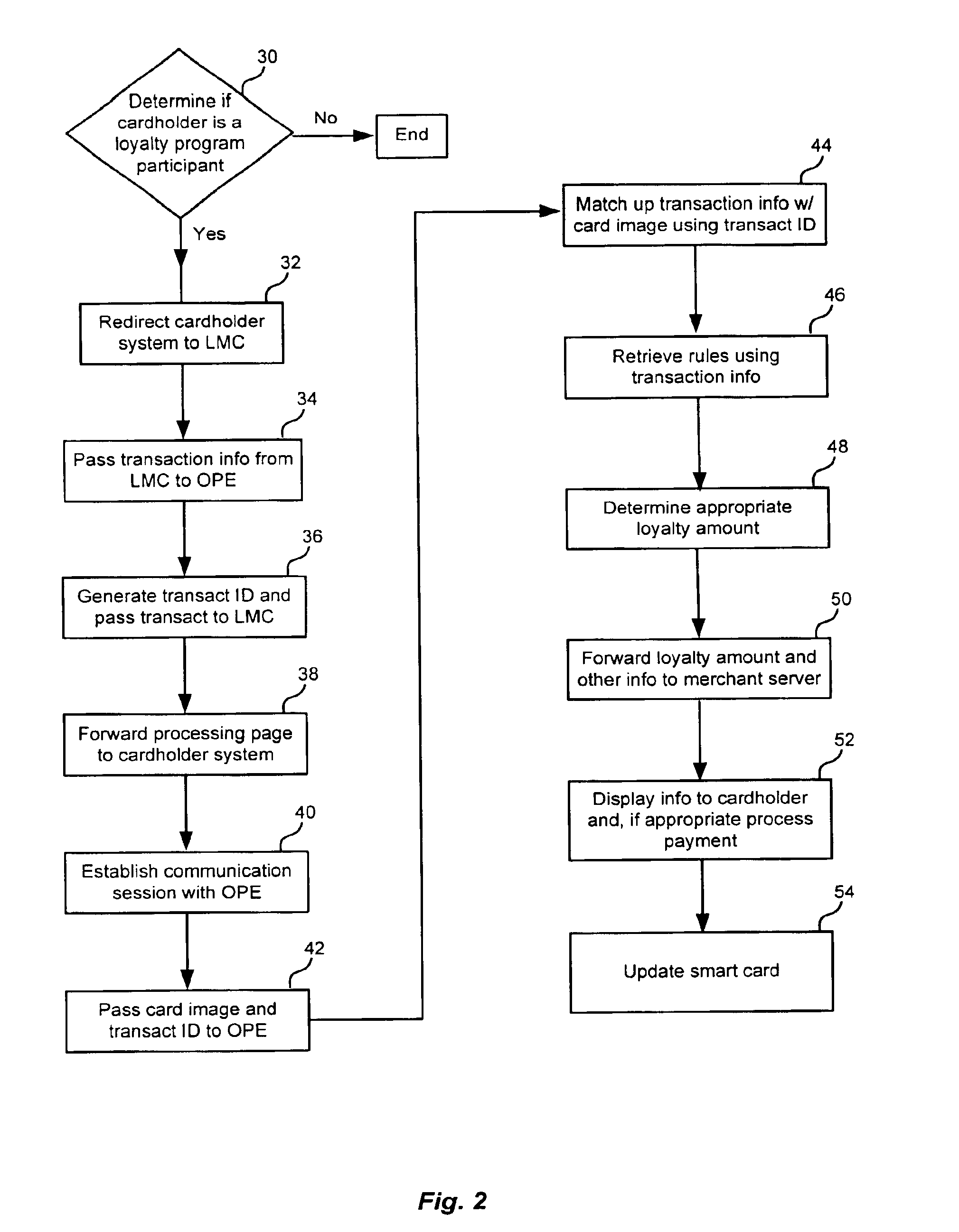

Method and system for implementing a loyalty merchant component

A loyalty merchant component for facilitating communications amongst cardholder systems, merchant servers and a loyalty host for purposes of processing loyalty transactions is provided. The loyalty merchant component performs a number of interface functions between the loyalty host and the merchant systems and the cardholder systems.

Owner:VISA USA INC (US)

Internet Payment, Authentication And Loading System Using Virtual Smart Card

InactiveUS20110125638A1The process is convenient and fastAdvantageous for small dollar amount transactionFinancePayment circuitsMerchant servicesWeb site

A system loads, authenticates and uses a virtual smart card for payment of goods and / or services purchased on-line over the Internet. An online purchase and load (OPAL) server includes a virtual smart card data base that has a record of information for each smart card that it represents for a user at the behest of an issuer. The server includes a smart card emulator that emulates a smart card by using the card data base and a hardware security module. The emulator interacts with a pseudo card reader module in the server that imitates a physical card reader. The server also includes a client code module that interacts with the pseudo card reader and a remote payment or load server. A pass-through client terminal presents a user interface and passes information between the OPAL server and a merchant server, and between the OPAL server and a bank server. The Internet provides the routing functionality between the client terminal and the various servers. A merchant advertises goods on a web site. A user uses the client terminal to purchase goods and / or services from the remote merchant server. The payment server processes, confirms and replies to the merchant server. The payment server is also used to authenticate the holder of a virtual card who wishes to redeem loyalty points from a merchant. To load value, the client terminal requests a load from a user account at the bank server. The load server processes, confirms and replies to the bank server.

Owner:VISA INT SERVICE ASSOC

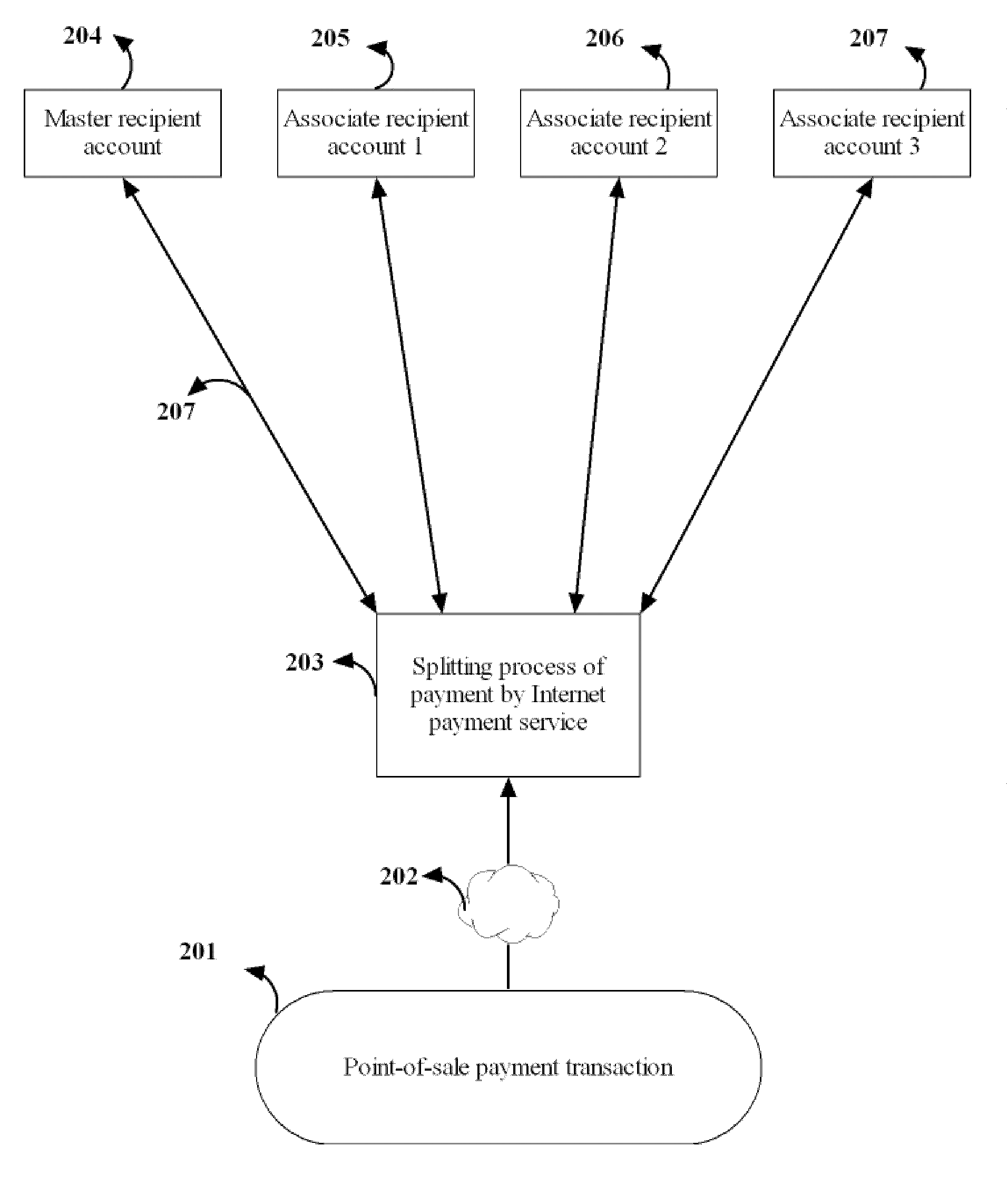

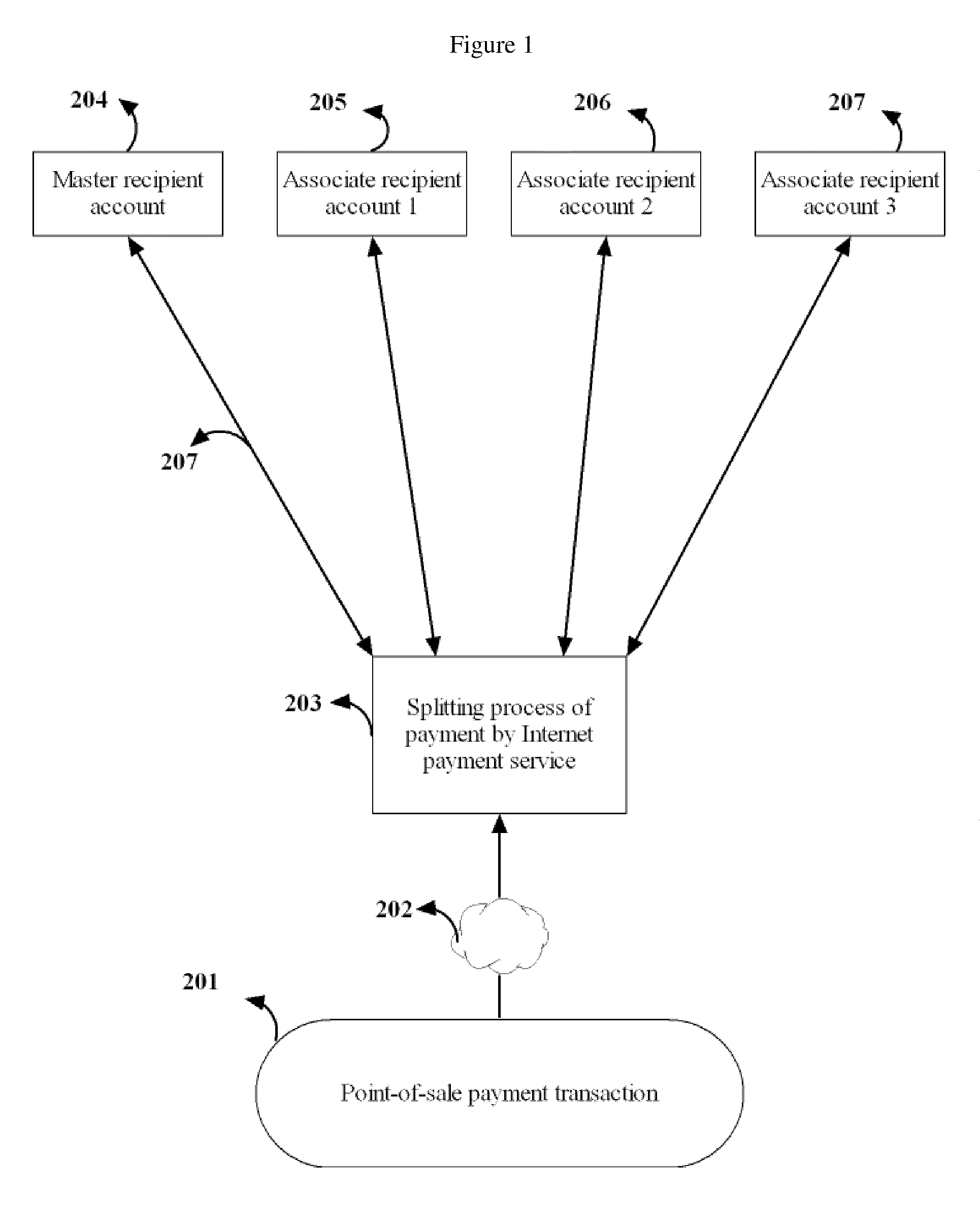

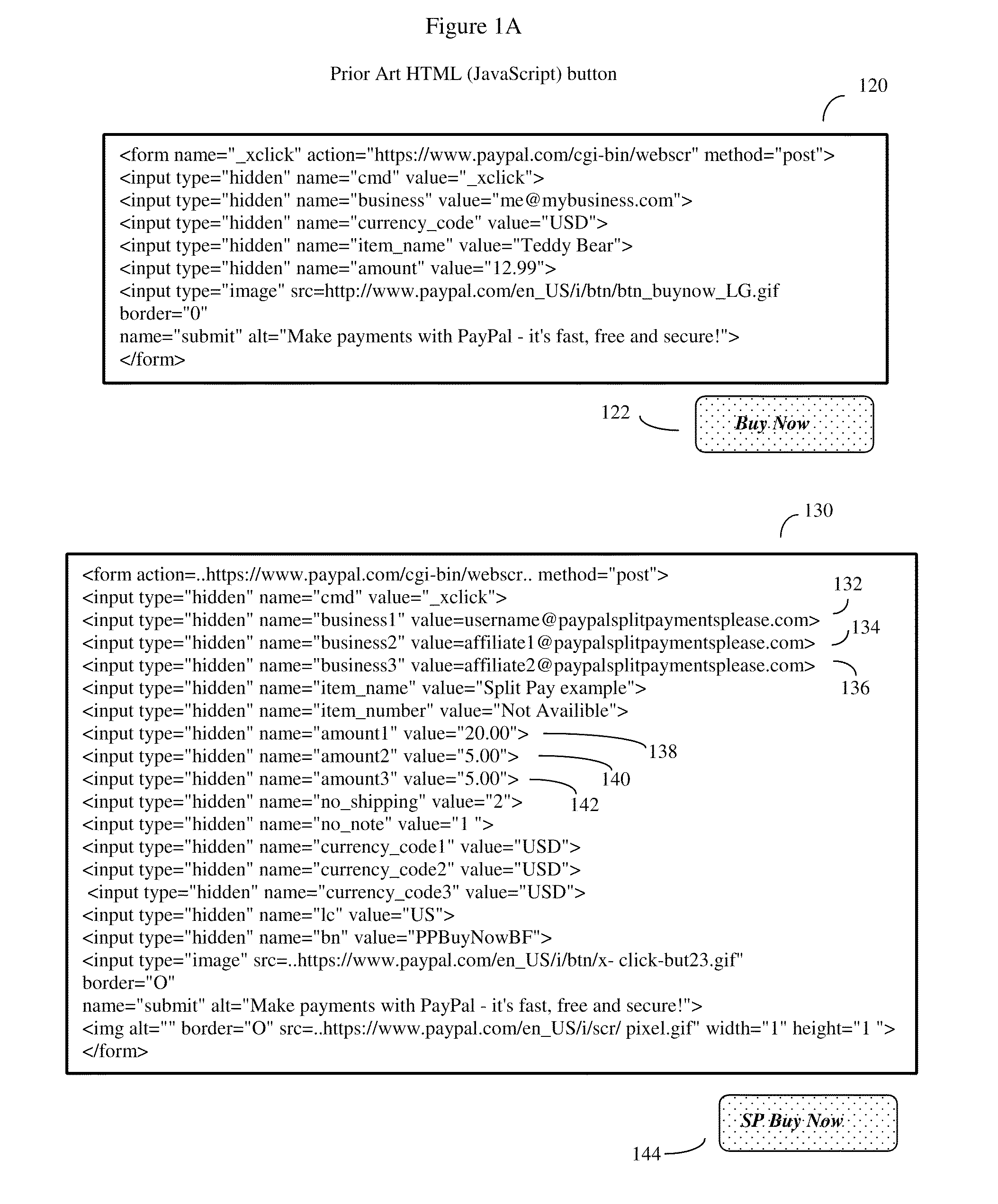

Point of sale payment method for multiple recipients using a digital payment service

InactiveUS20100010906A1Ensure trustEasy accessHand manipulated computer devicesFinanceMerchant servicesPayment

The method allows the funds from the purchase of a single item to be automatically divided and distributed to multiple recipients according to pre-arranged royalty and percent ownership arrangements. The purchase of multiple items can also be managed this way. In one embodiment, the method may employ JavaScript fee-split code that can be uploaded from a remote merchant server. The code can be executed within the web browser of a buyer's computerized device, and then send instructions over the Internet to the API of an automated Internet ecommerce system. The ecommerce system will then automatically split the buyer's single item payment to multiple recipients, and automatically credit the escrow account of the multiple recipients at the time of the buyer's purchase. In another embodiment, the details of the fee split arrangement can be stored in the remote ecommerce system, and be automatically invoked when the user makes a purchase.

Owner:GRECIA WILLIAM

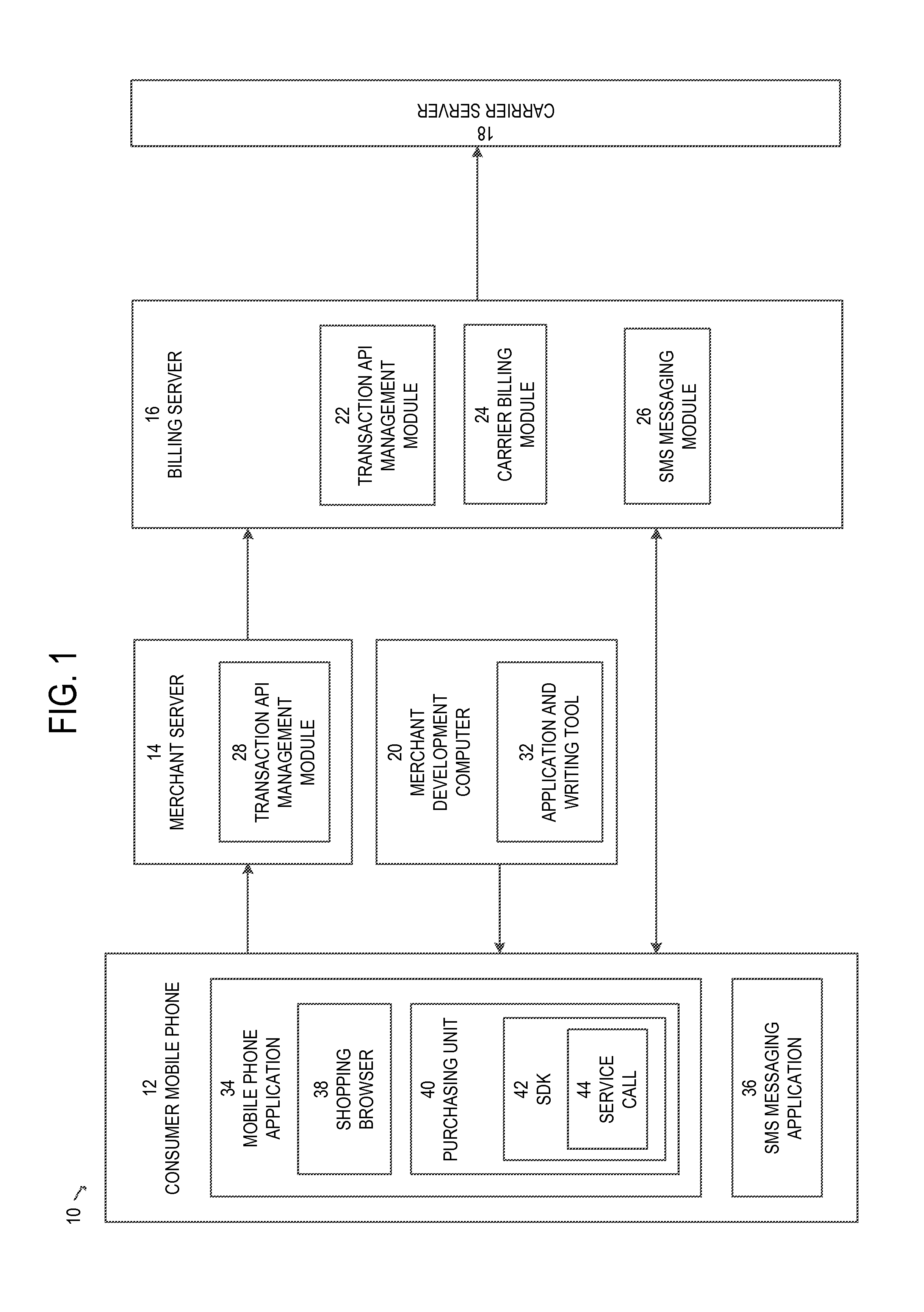

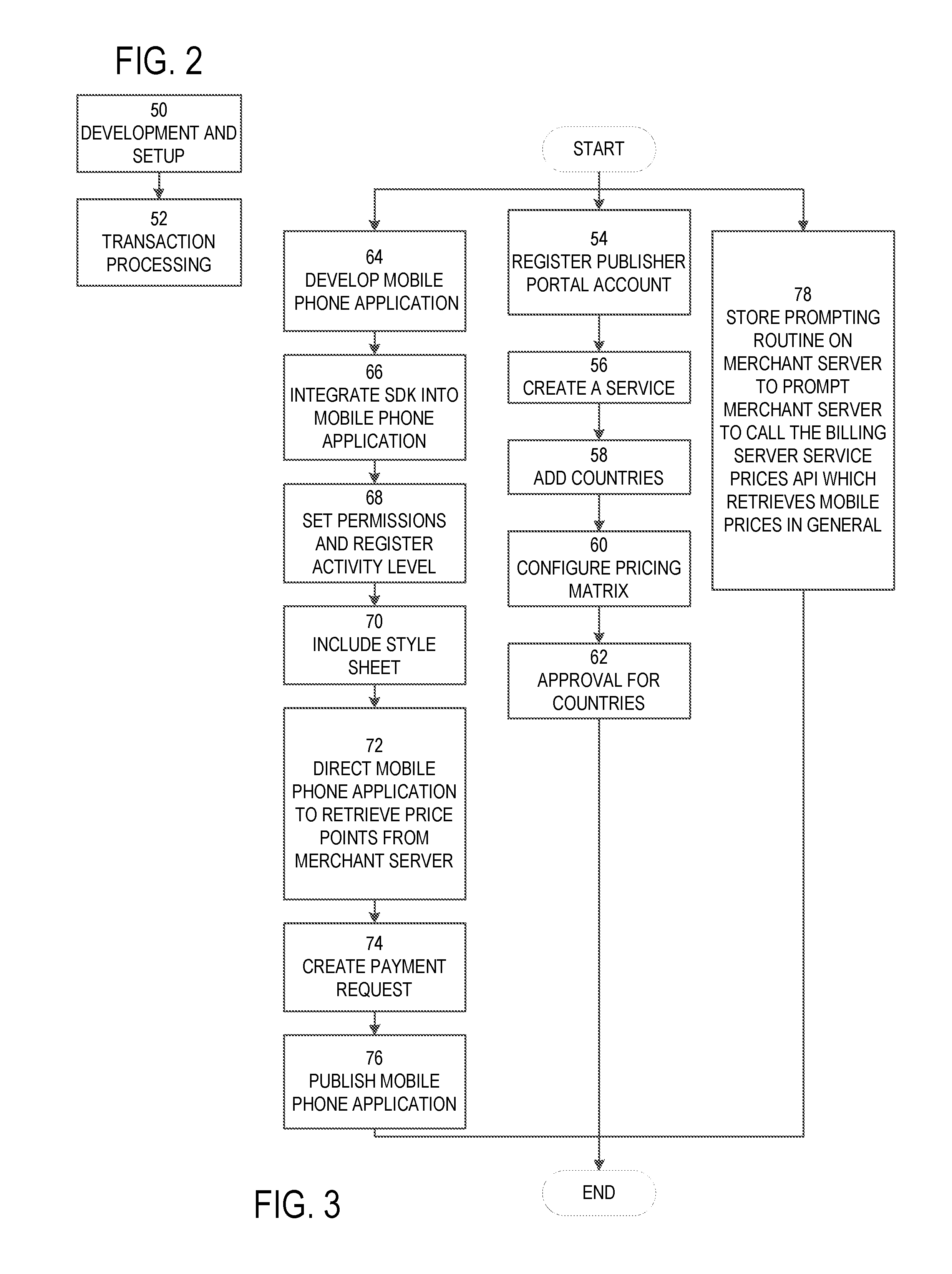

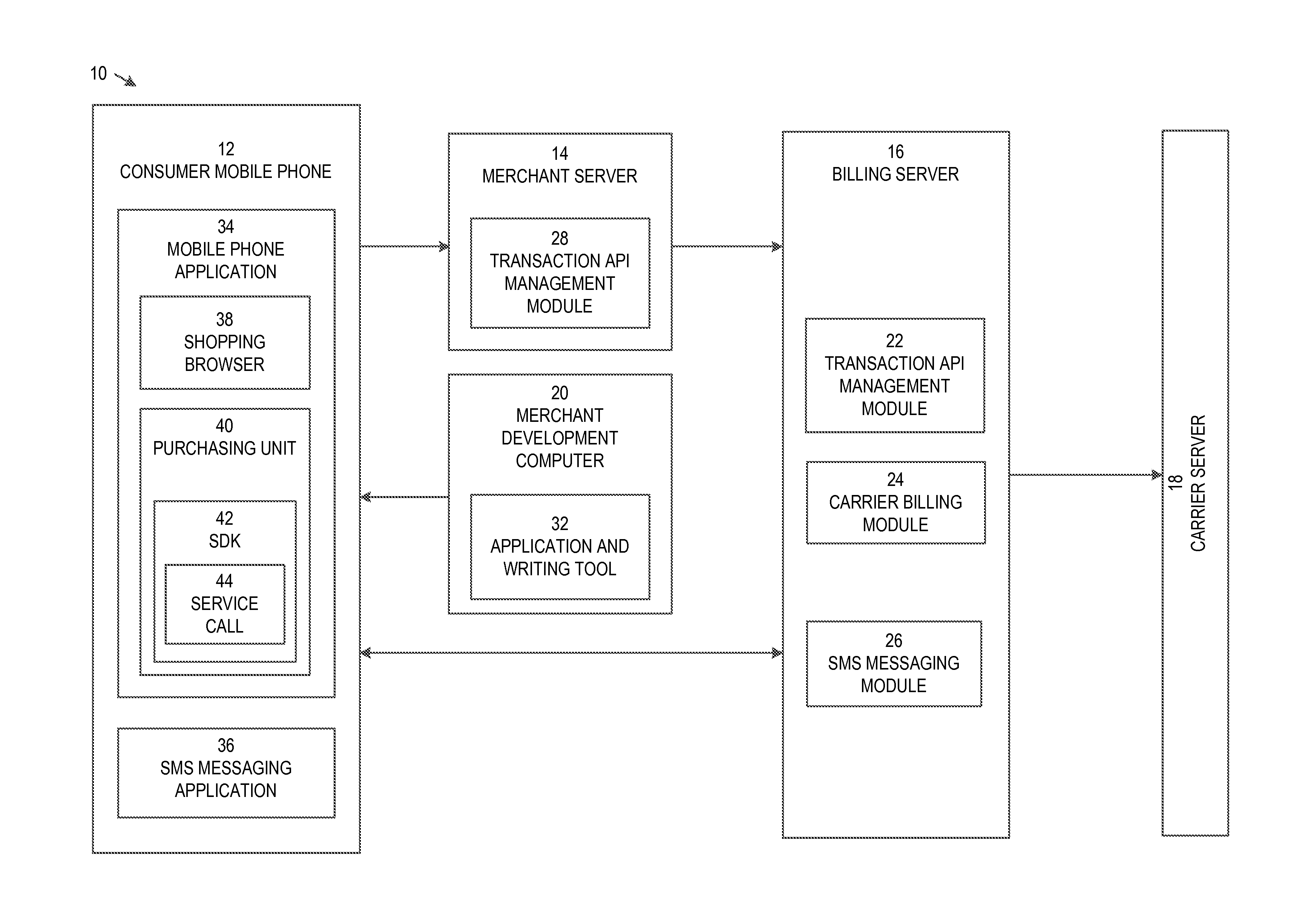

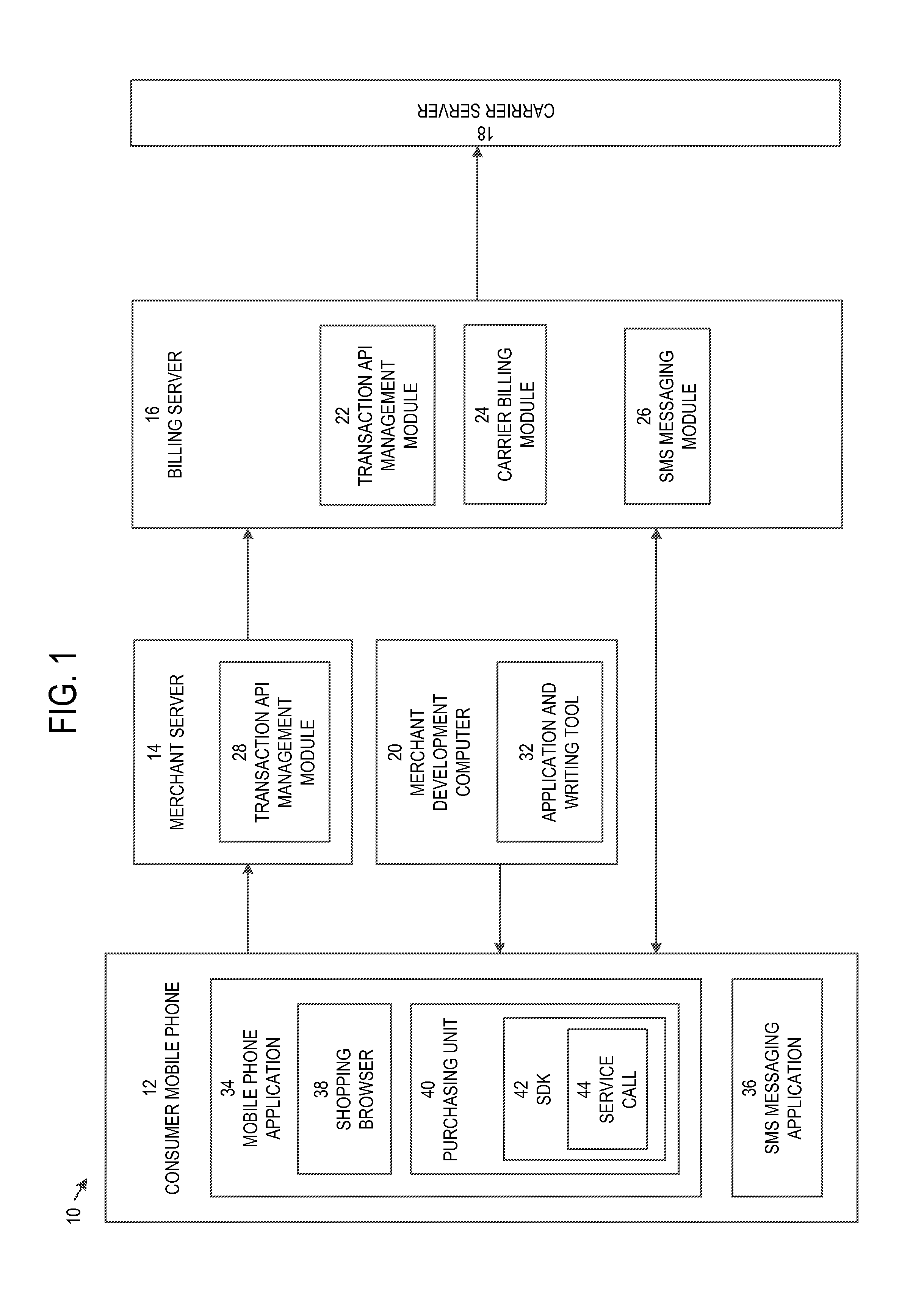

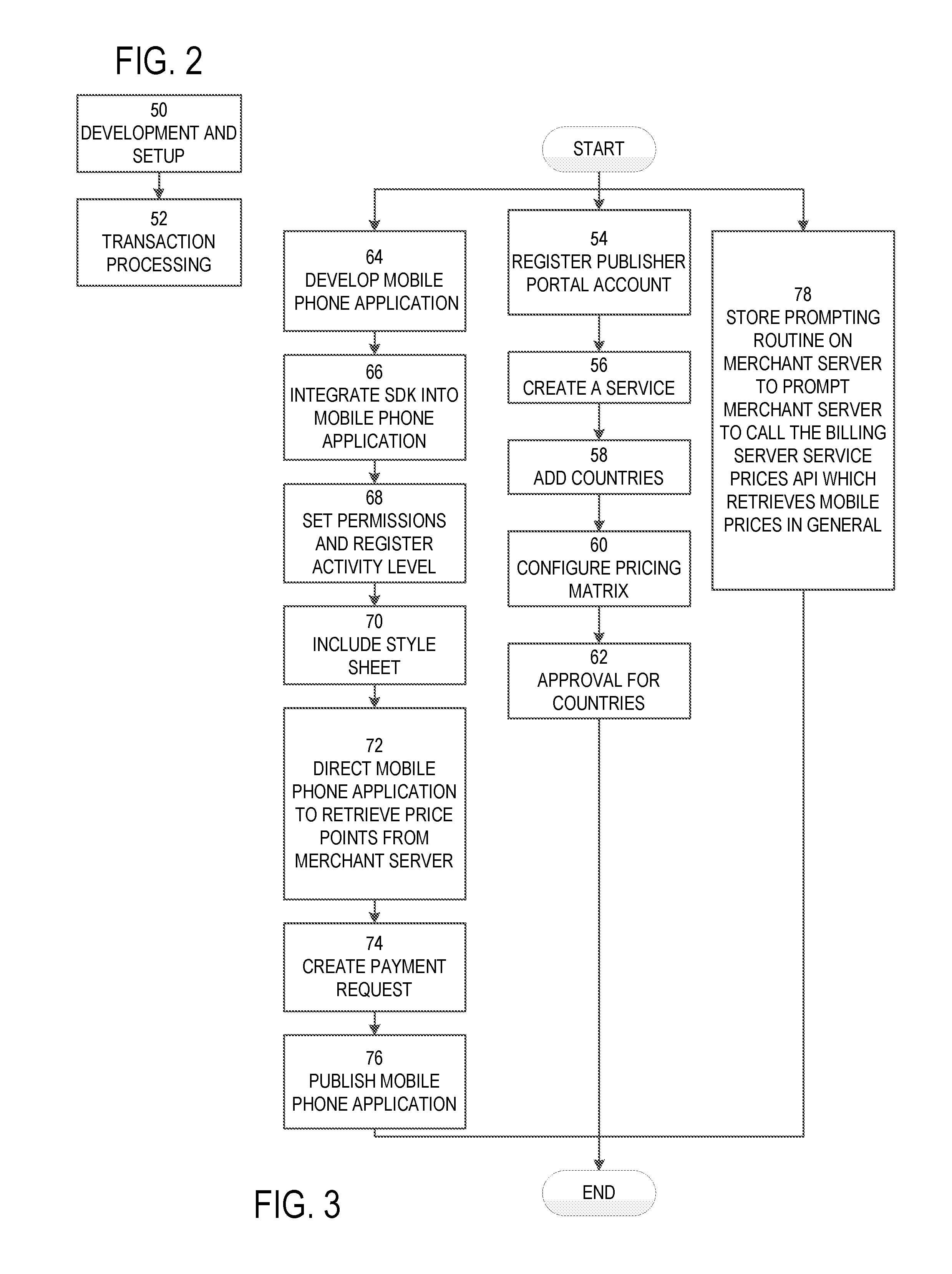

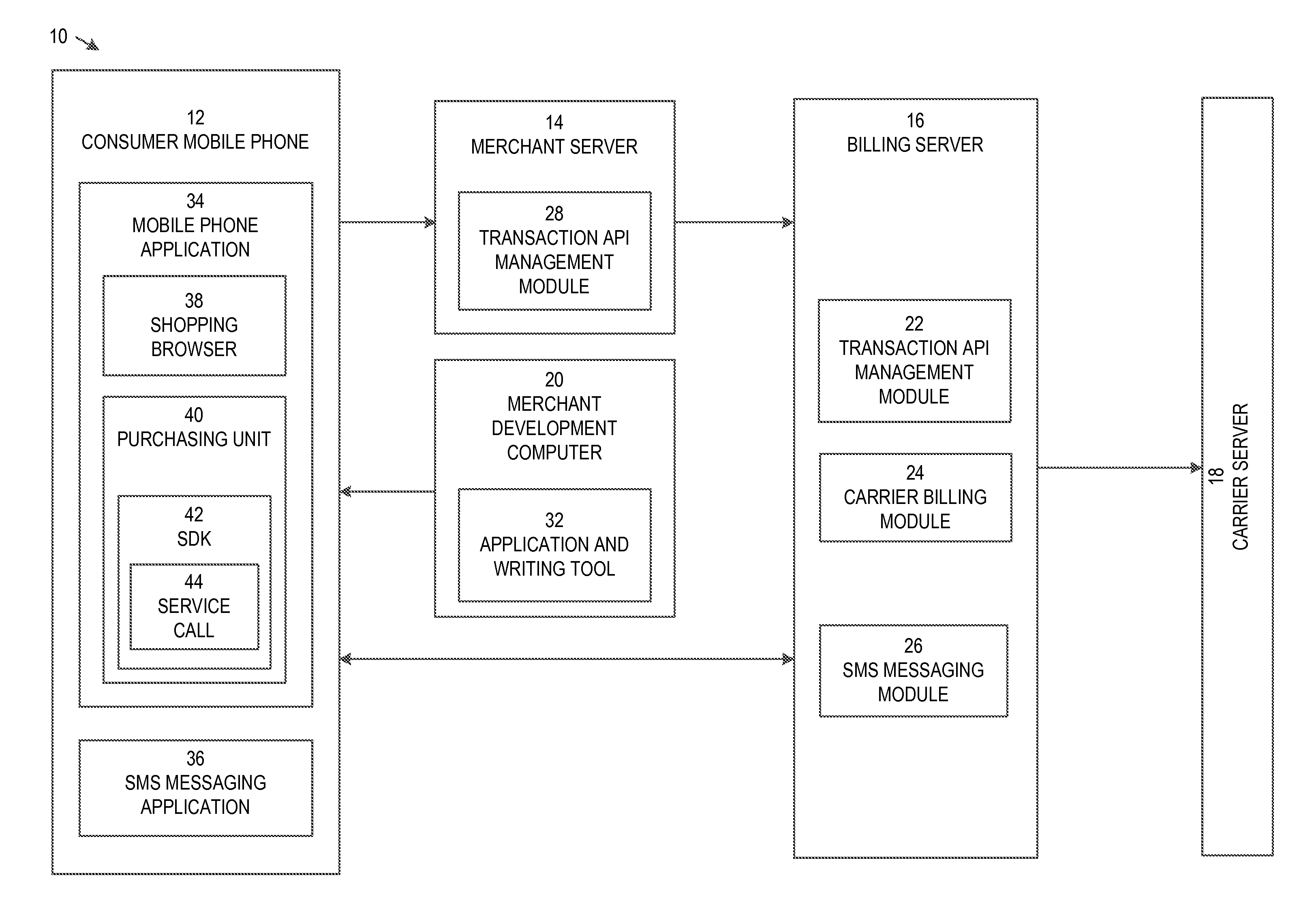

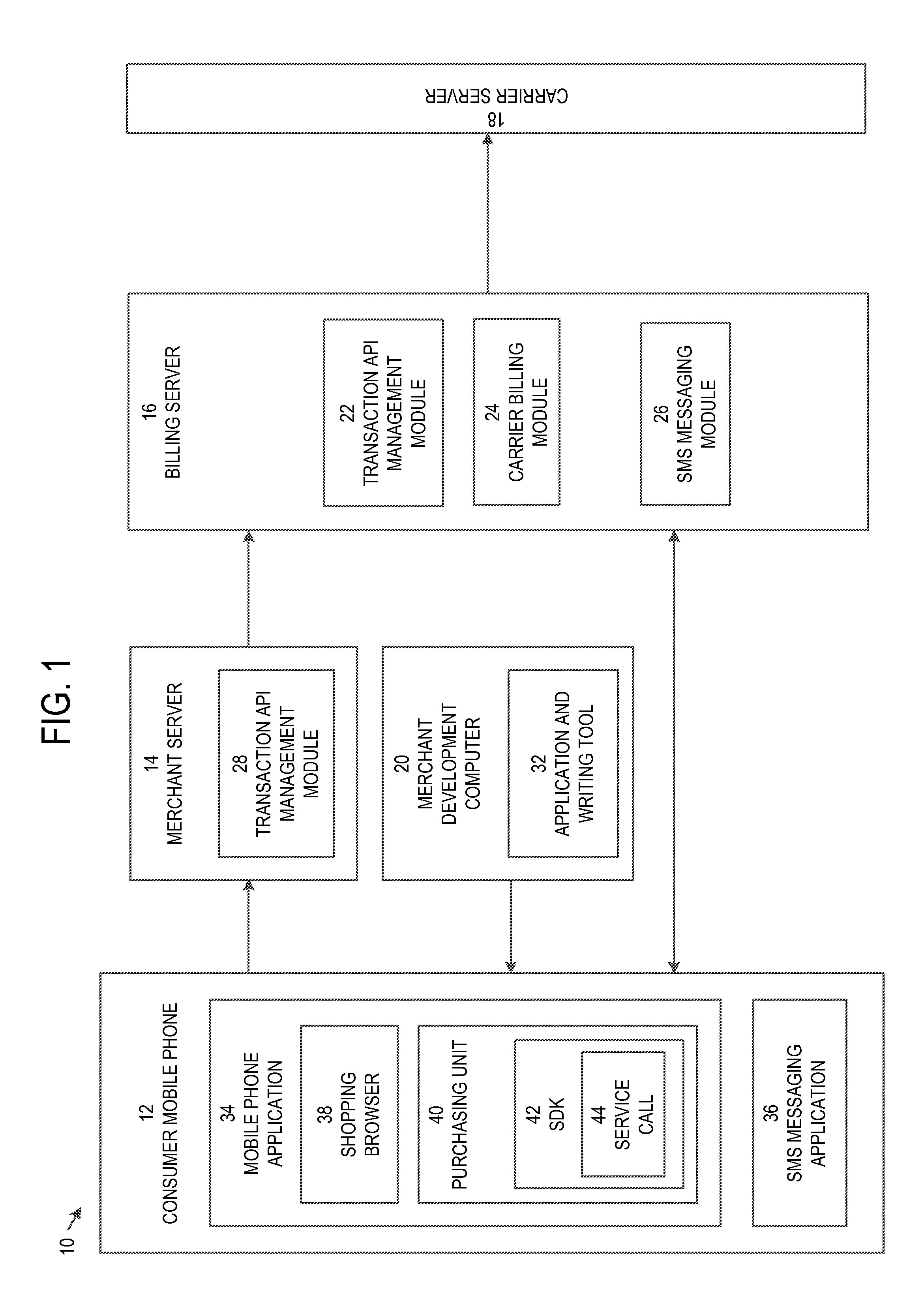

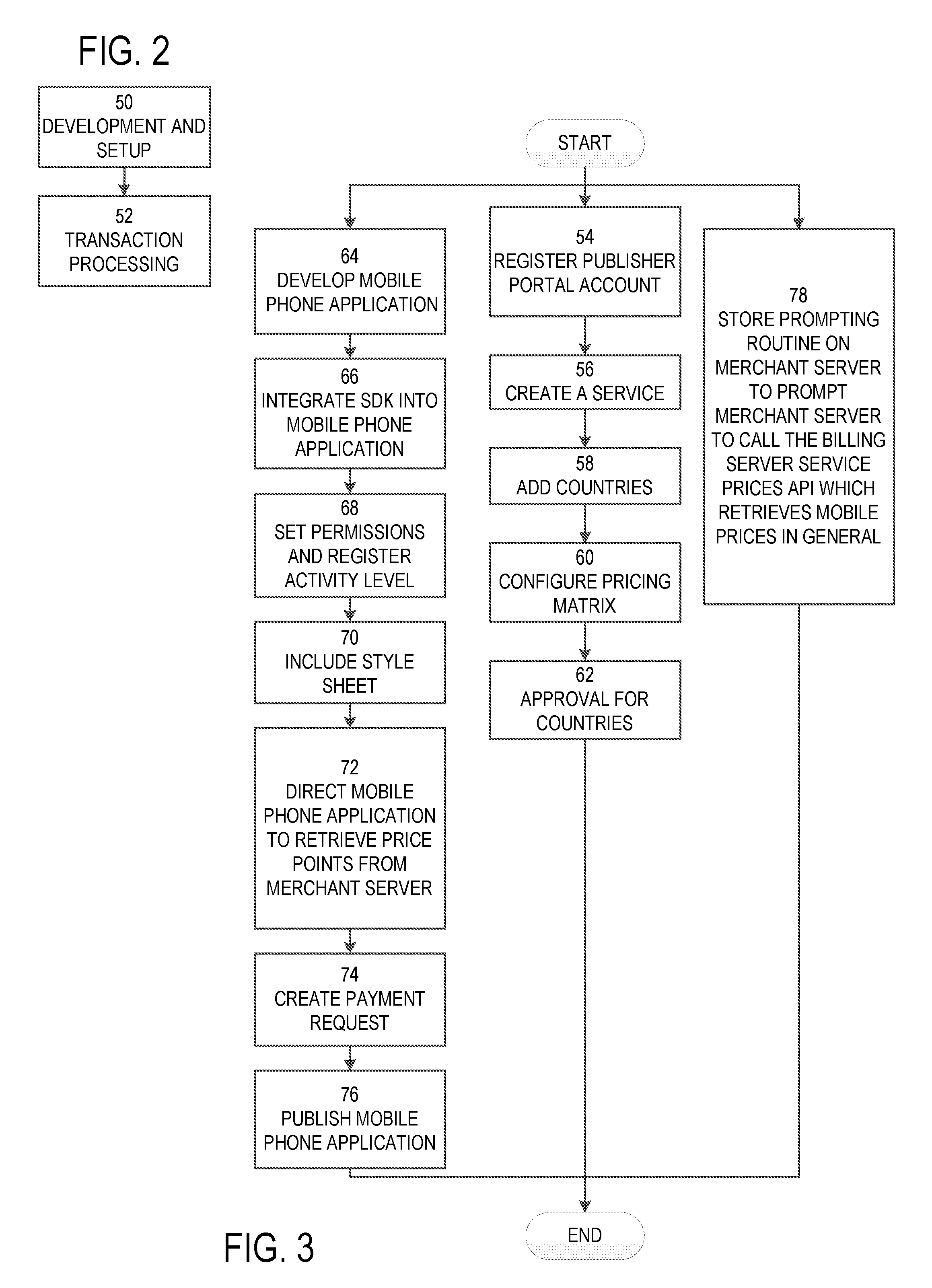

Configurable price matrix for mobile billing at a merchant server

ActiveUS9014664B2Accounting/billing servicesTelephonic communicationMerchant servicesApplication software

Owner:BOKU

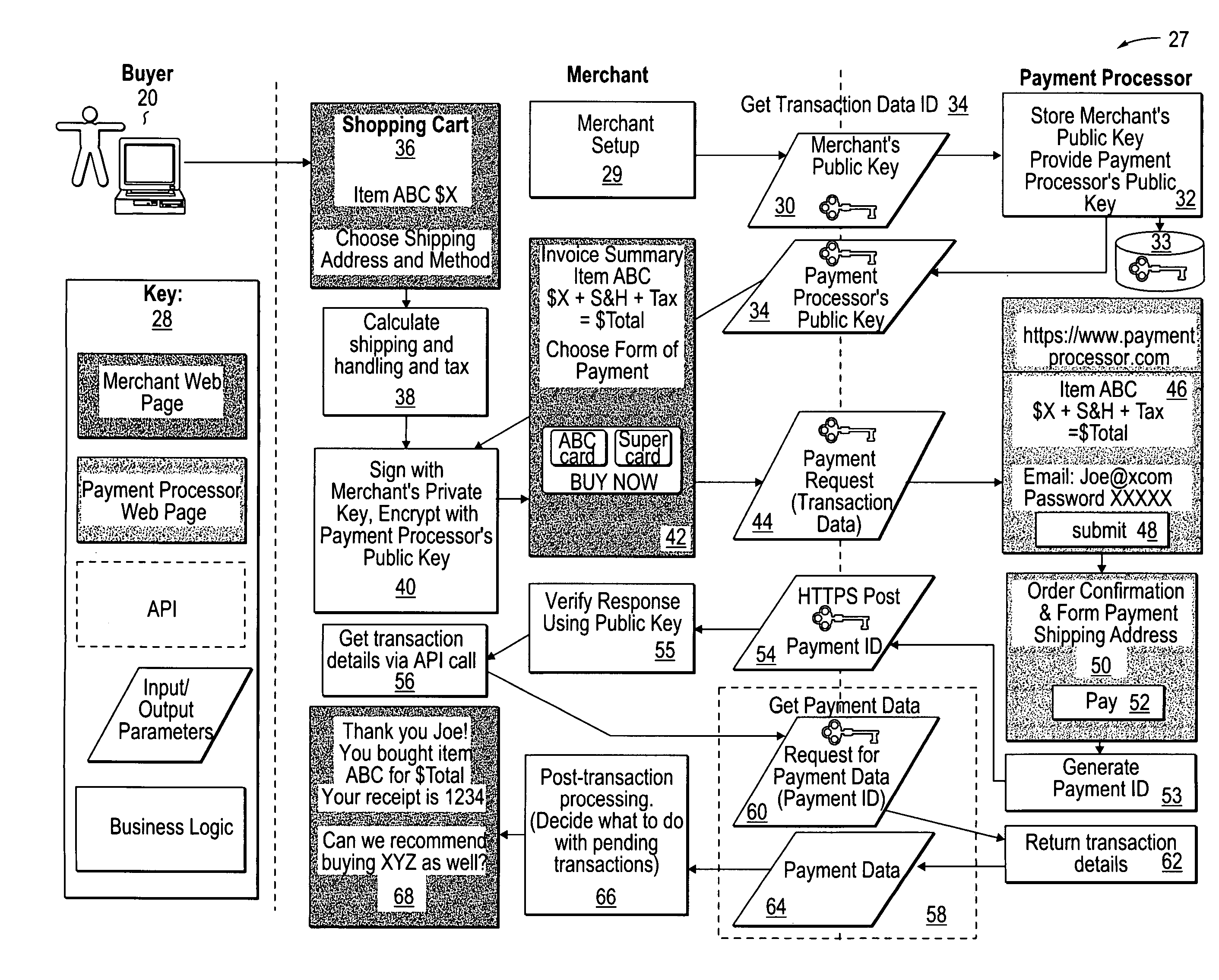

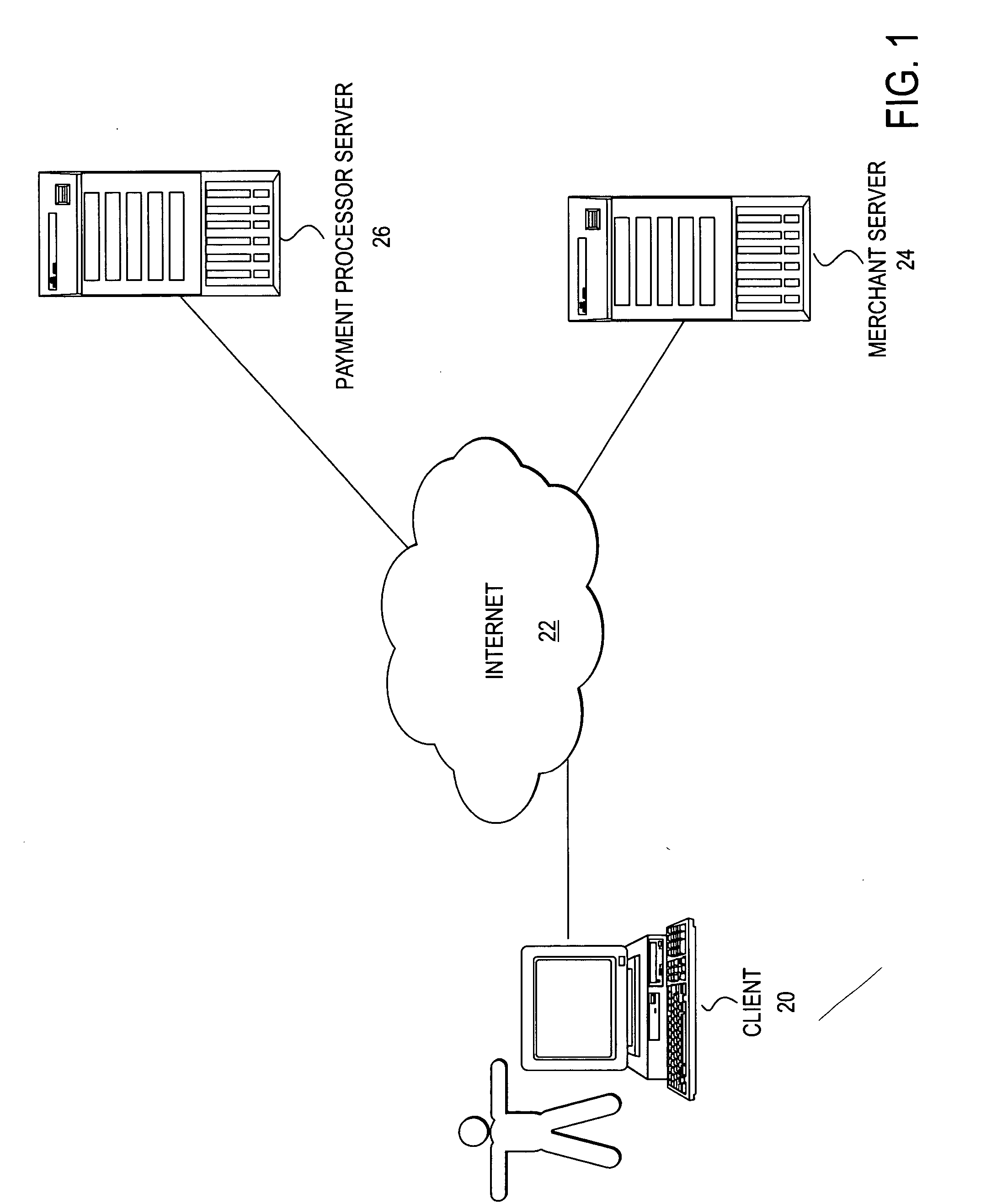

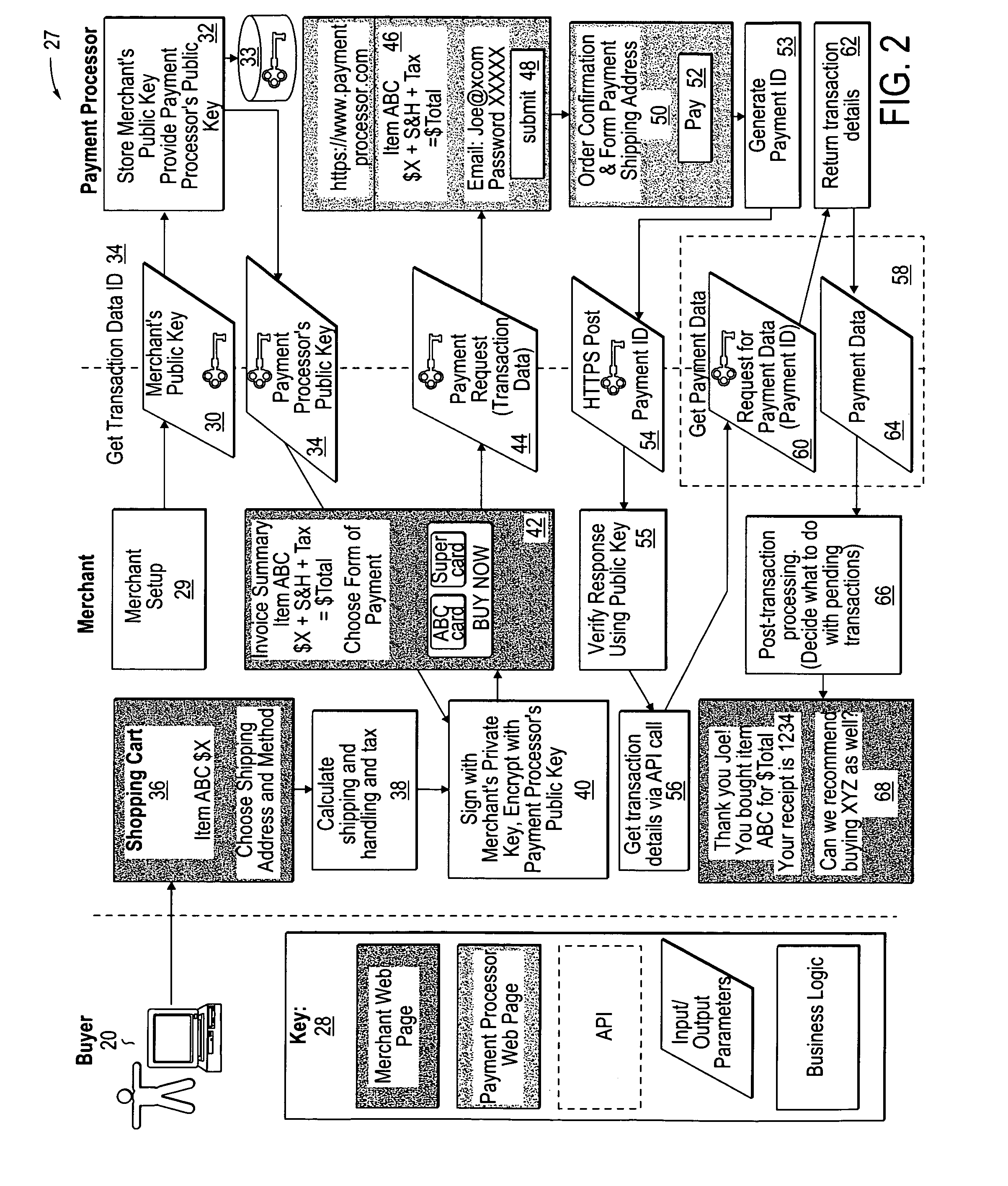

Method and system to facilitate securely processing a payment for an online transaction

ActiveUS20050256806A1Buying/selling/leasing transactionsPayment circuitsMerchant servicesInternet privacy

A computer-implemented method, to facilitate processing a payment for an online transaction, includes, responsive to receiving secure transaction data from a merchant server, using a payment processor to generate a transaction data identifier to identify the transaction data. The payment processor communicates the transaction data identifier to the merchant server. In response to receiving a request to process a payment, including the transaction data identifier, the payment processor requests user credentials from a user. Upon receiving user credentials from the user, the payment processor verifies the user credentials. The payment processor processes the payment and generates a payment identifier to identify payment data associated with the payment. The payment processor communicates the payment identifier to the merchant server. Upon receiving a request for payment data, including the payment identifier, over a secure communication channel from the merchant server, the payment processor communicates the payment data to the merchant server.

Owner:PAYPAL INC

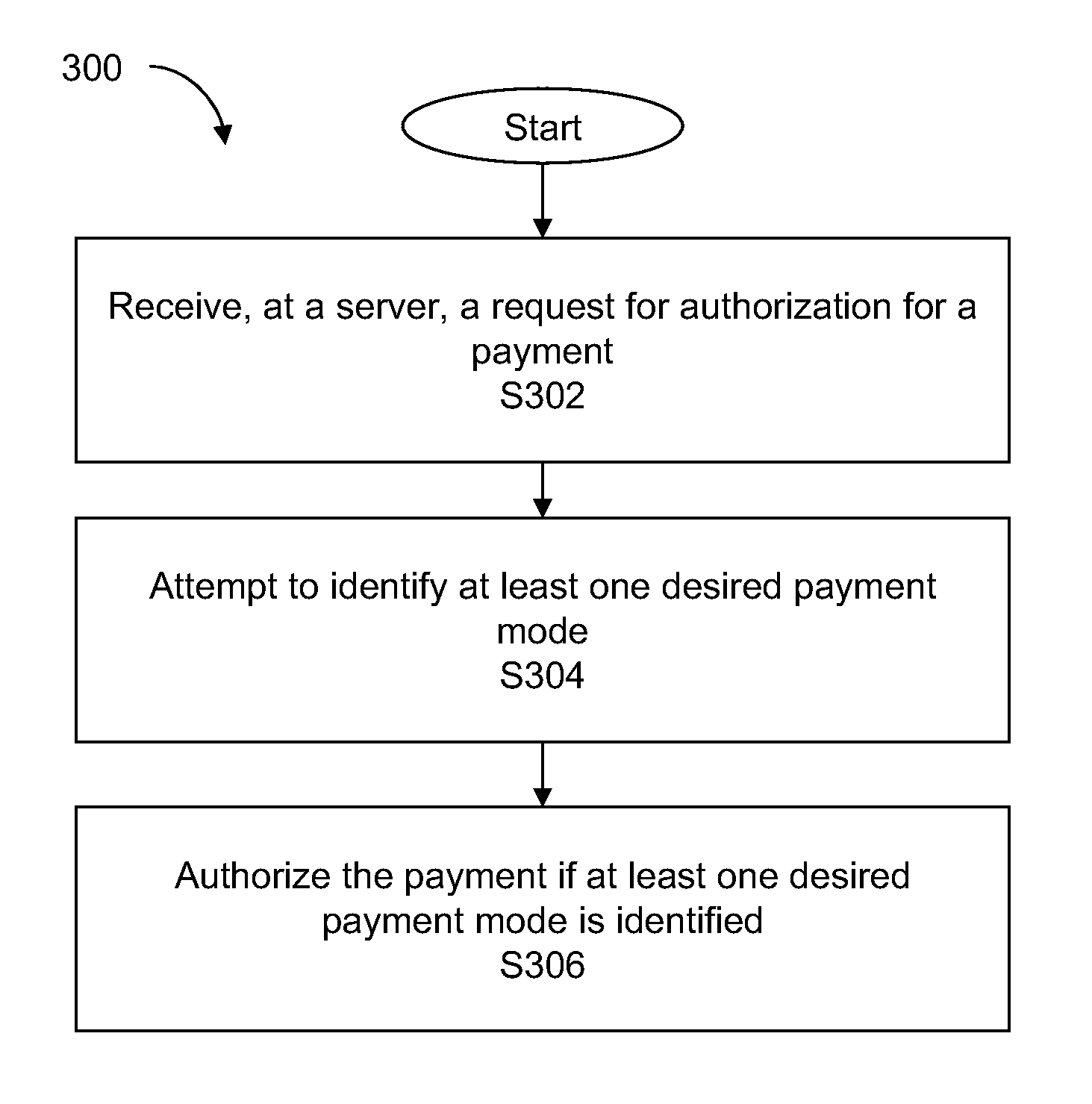

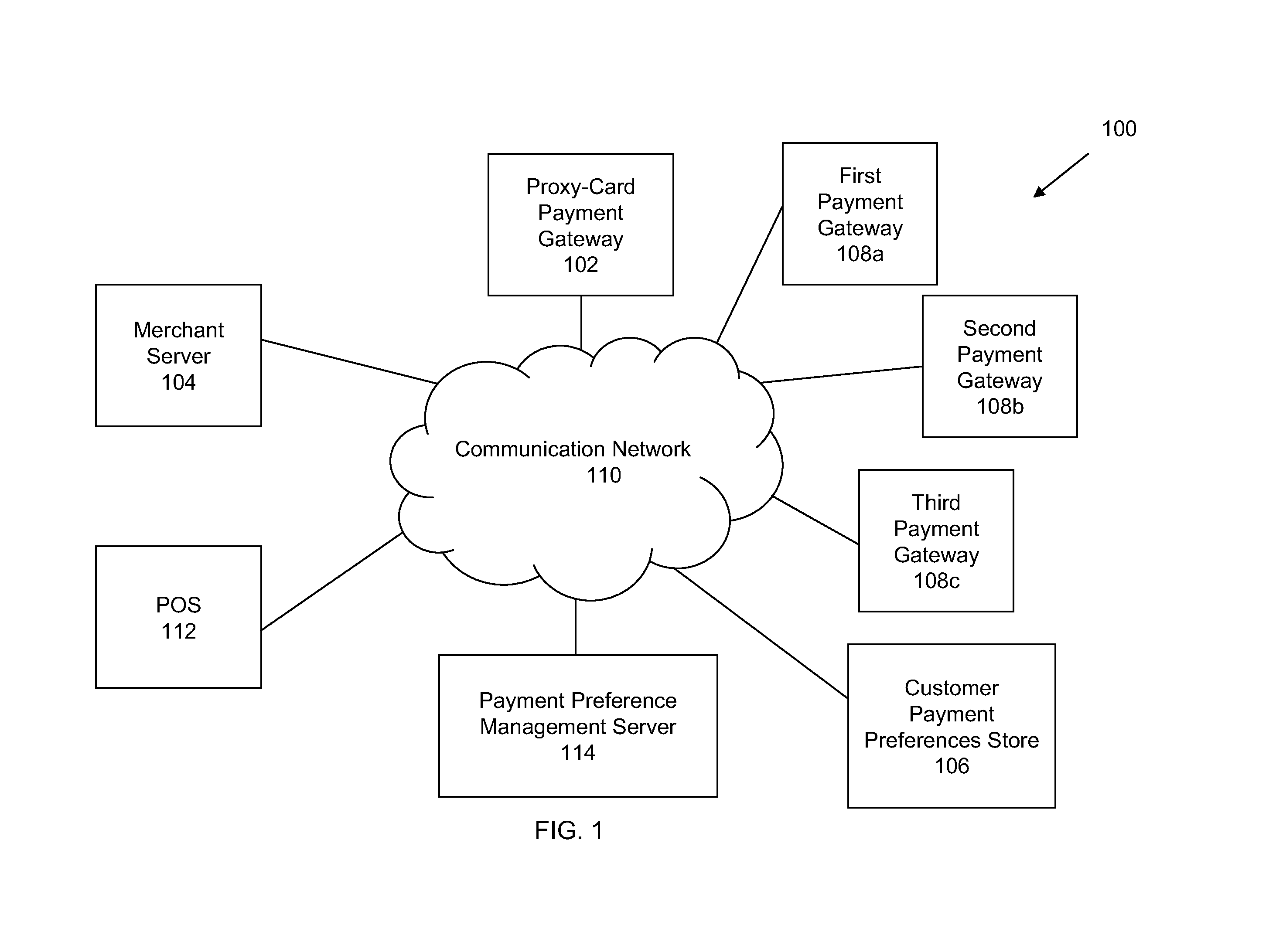

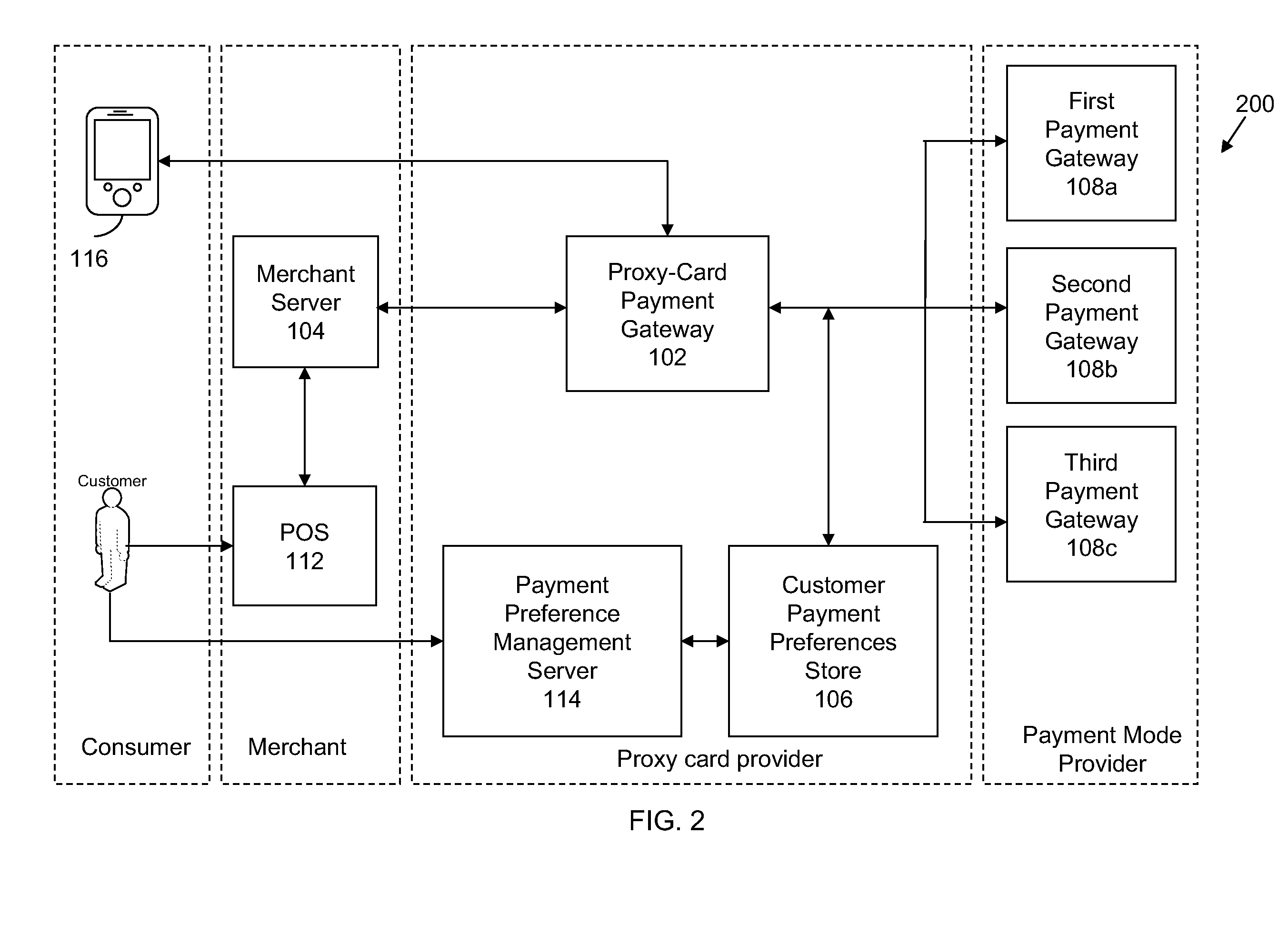

Systems, methods, and computer products for processing payments using a proxy card

Systems, methods and computer program products for processing payments for a proxy card are provided. Embodiments of the system include a processor, and a memory in communication with the processor. The memory may be configured to store processing instructions for directing the processor to receive a request for authorization of a payment. In various embodiments, the request is triggered at a merchant server, by the use of a proxy card of the customer. The processor attempts to identify at least one desired payment mode for making the payment, from among payment mode(s) associated with the proxy card. The processor first selects the payment modes based at least in part on one or more selection criteria, such as predefined customer goals, and then the processor performs an authorization check to identify the desired payment modes. Subsequently, the processor authorizes the payment if at least one desired payment mode is identified.

Owner:LIBERTY PEAK VENTURES LLC

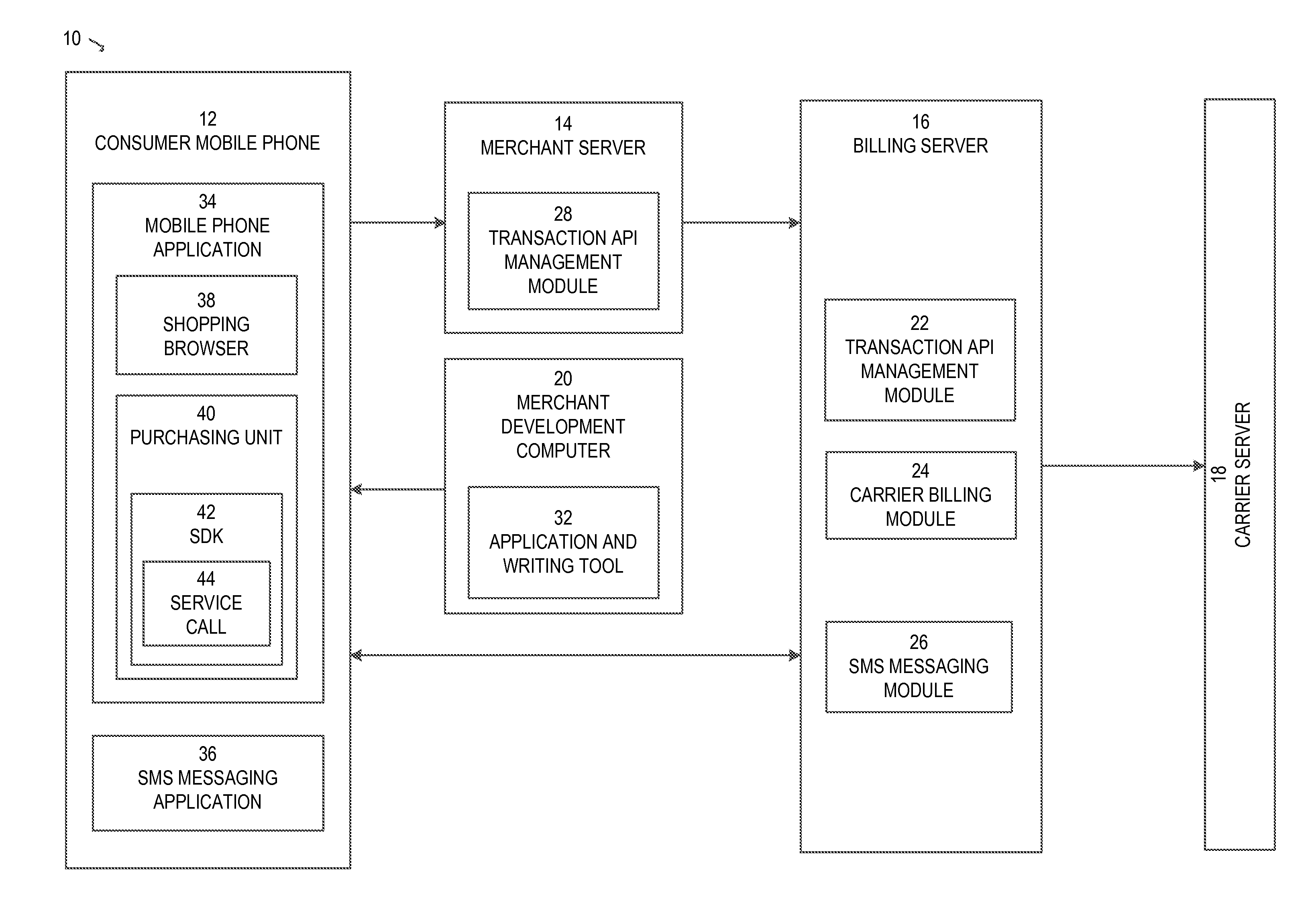

Configurable price matrix for mobile billing at a merchant server

ActiveUS20150004932A1Accounting/billing servicesTelephonic communicationMerchant servicesApplication software

A method of processing transactions is described. A pricing matrix is configured on a billing server. The pricing matrix has a set of cells, each cells corresponding to an intersection between a respective country and a respective target price. The merchant server downloads the pricing matrix periodically from the billing server. The merchant server determines a country of a consumer mobile phone and displays price points corresponding to the country within a mobile phone application. When the consumer selects one of the price points a transaction is processed between the consumer mobile phone, the billing server and a carrier server aligned with the billing server.

Owner:BOKU

Configurable price matrix for mobile billing at a billing server

ActiveUS20150004933A1Accounting/billing servicesTelephonic communicationMerchant servicesApplication software

A method of processing transactions is described. A pricing matrix is configured on a billing server. The pricing matrix has a set of cells, each cells corresponding to an intersection between a respective country and a respective target price. The merchant server downloads the pricing matrix periodically from the billing server. The merchant server determines a country of a consumer mobile phone and displays price points corresponding to the country within a mobile phone application. When the consumer selects one of the price points a transaction is processed between the consumer mobile phone, the billing server and a carrier server aligned with the billing server.

Owner:BOKU

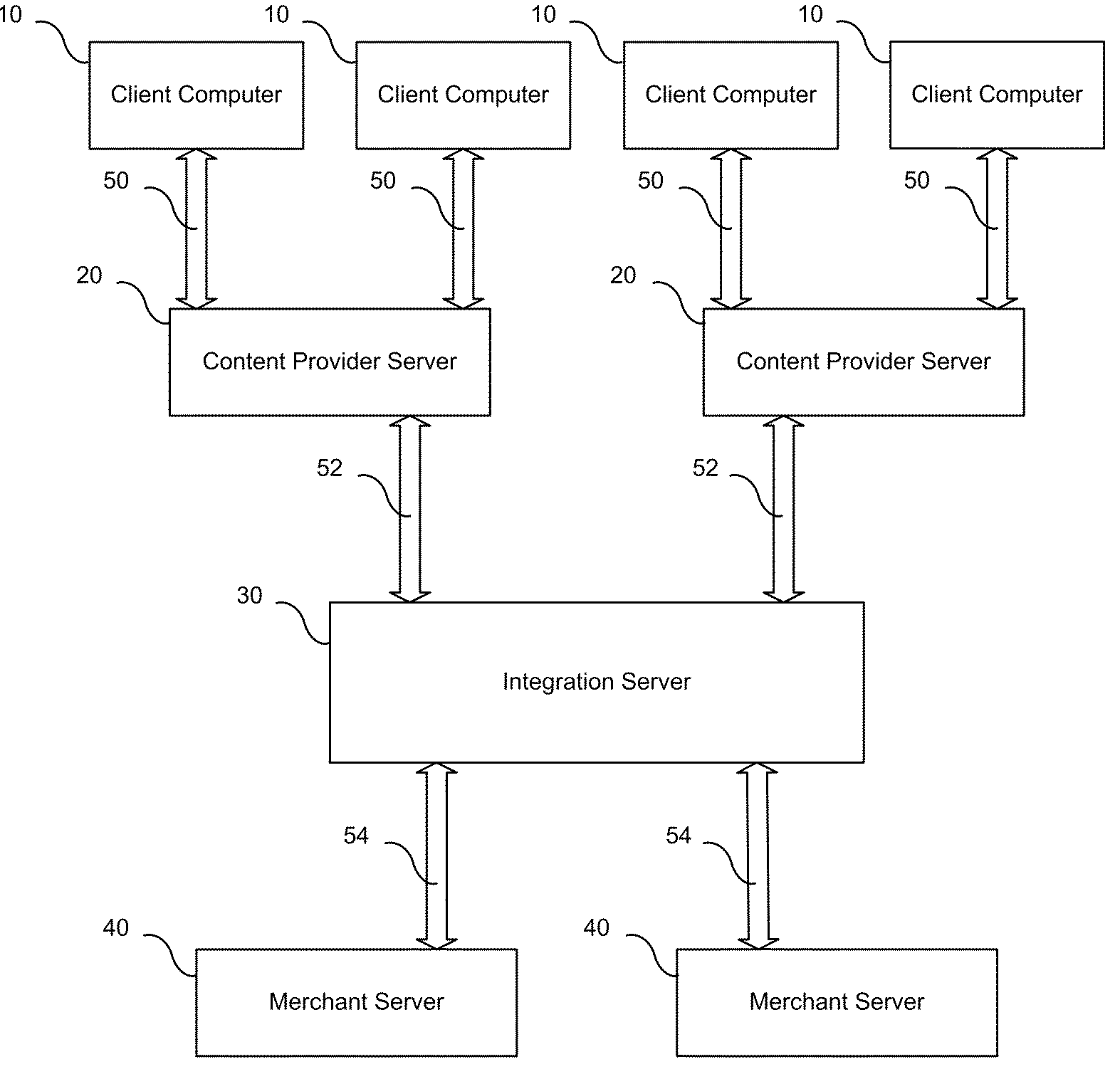

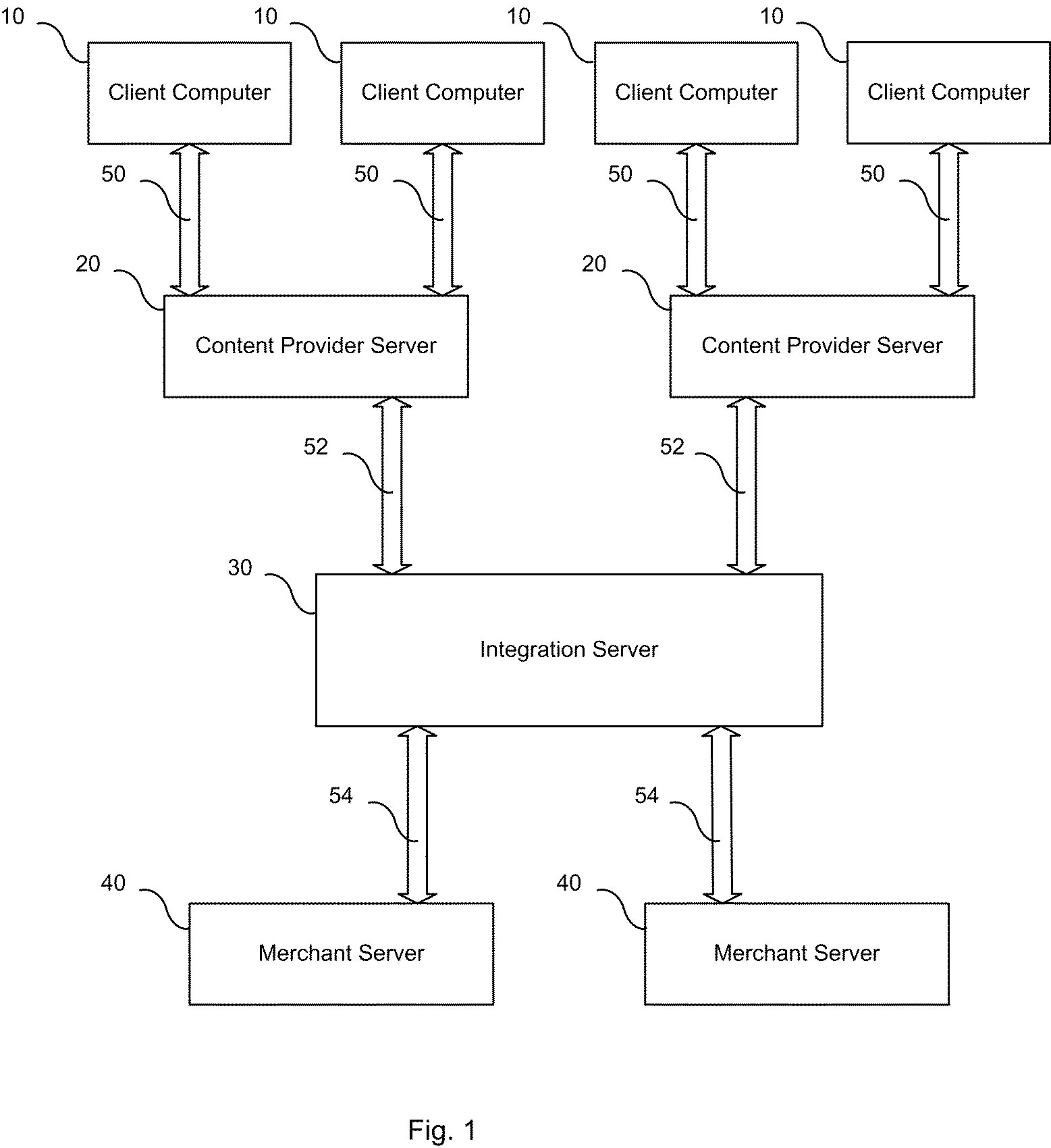

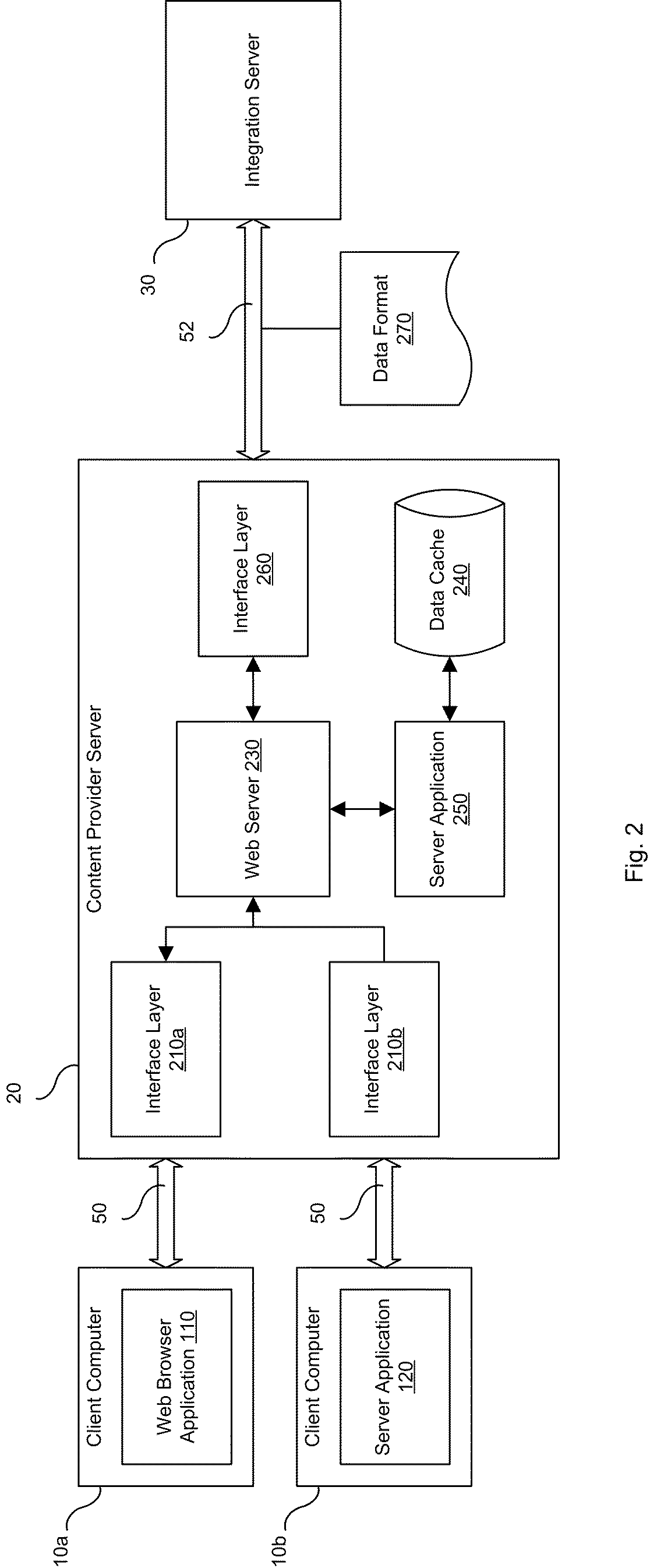

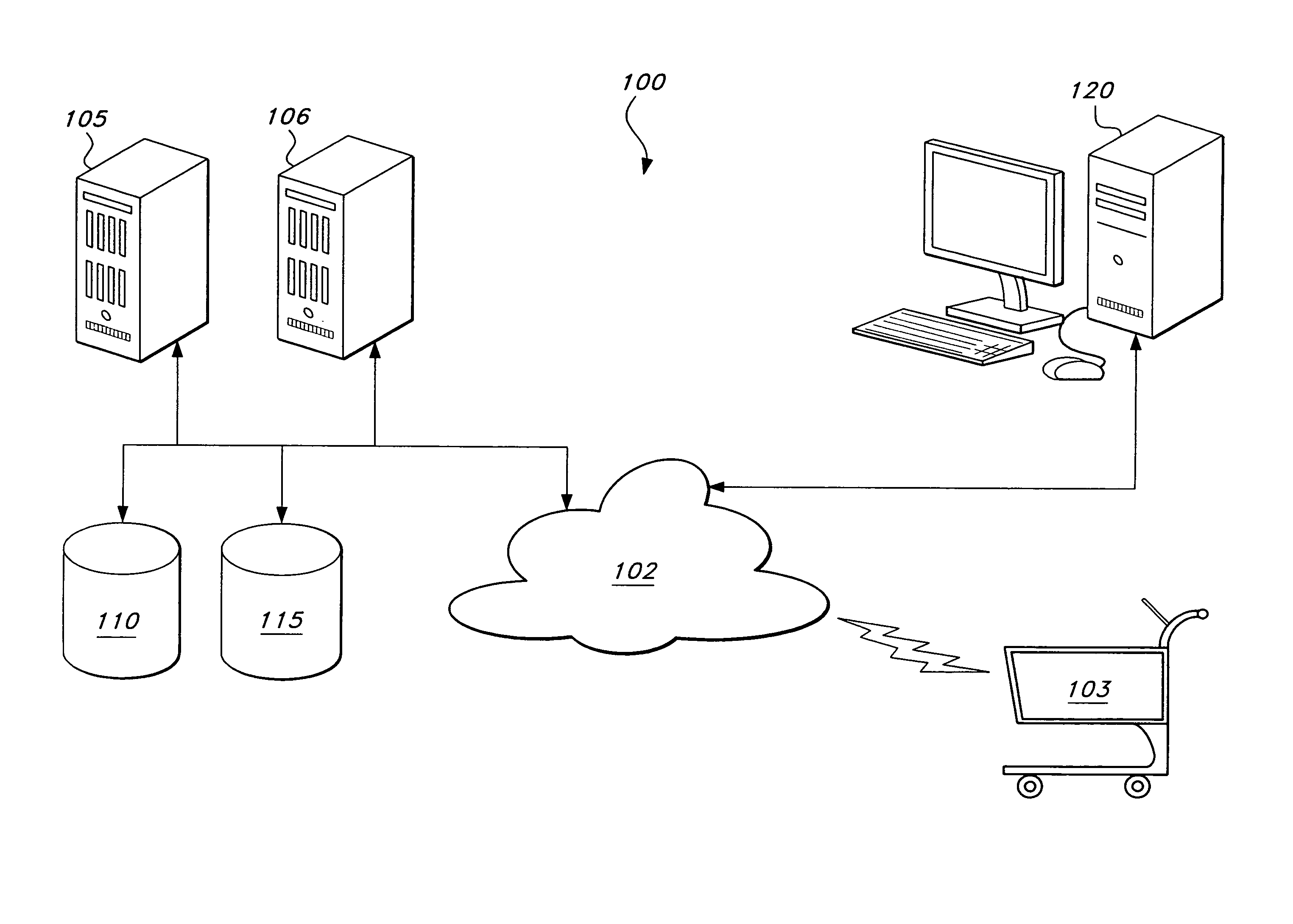

Electronic commerce method and system utilizing integration server

InactiveUS20050102227A1Customer retentionFacilitate and reduce costFinancePayment architectureMerchant servicesE-commerce

An electronic commerce system integrating plurality of content provider servers with plurality of merchant servers having integration server communicating request for commercial transaction to at least one merchant server, thus enabling the user of the client computer connected to the content provider server to initiate commercial transactions to at least one merchant server without being redirected to the merchant server away from the content provider server. The system increases customer retention on the content provider server, thereby increasing incentive for content providers to join the commerce system, thereby increasing the number of sites advertising products offered by merchants. The system also simplifies integration of multitude of servers, thereby reducing cost and time required for such integration.

Owner:SOLONCHEV ALEKSEY

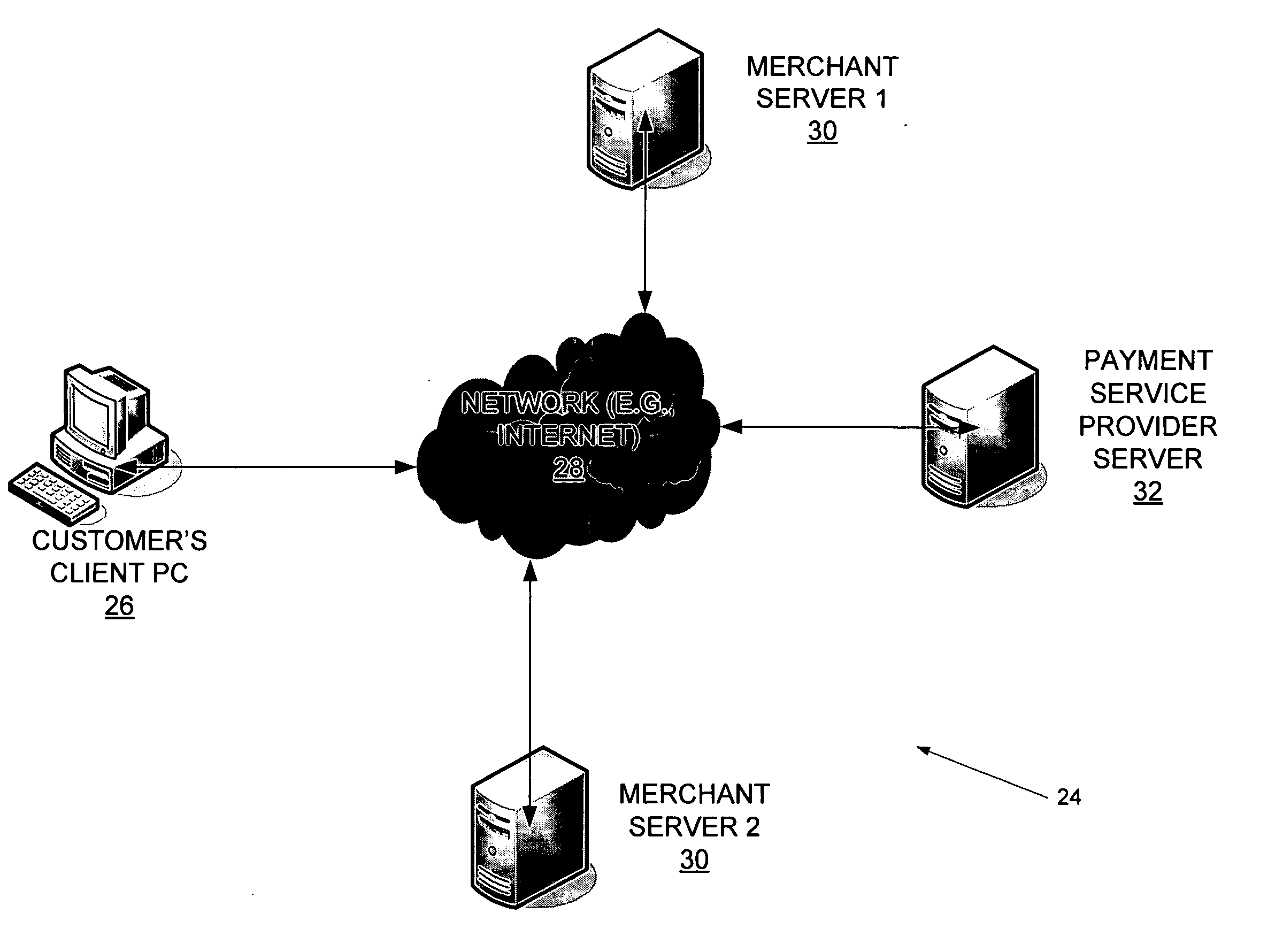

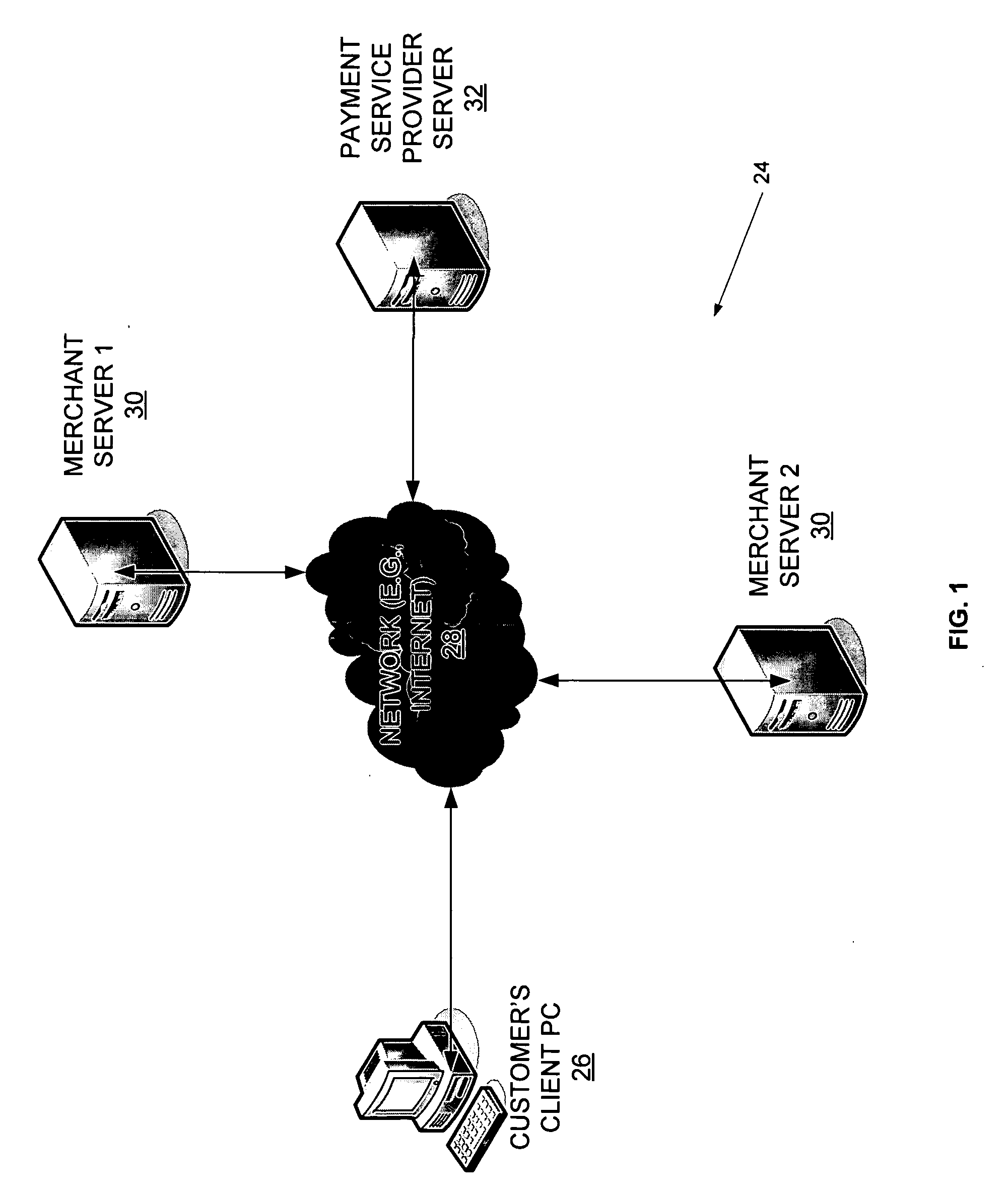

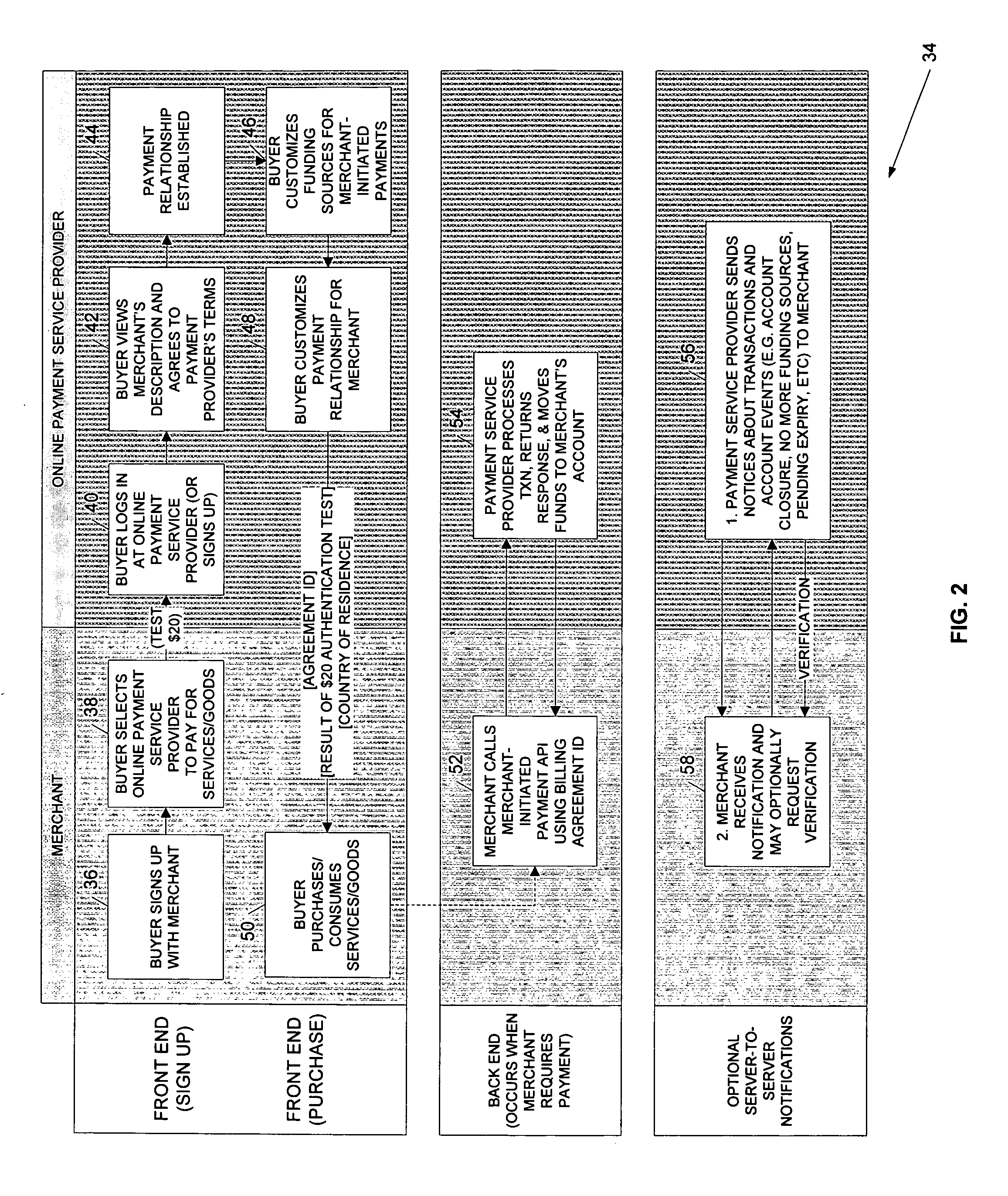

Method and system for facilitating merchant-initiated online payments

A method and system for facilitating merchant-initiated online payments are disclosed. According to one aspect of the present invention, a payment service provider's server receives a user's request, via a merchant's server, to establish a merchant-initiated payment relationship or agreement. Accordingly, the payment service provider presents the user with options to customize the terms of the merchant-initiated payment agreement. After the agreement has been established and the terms customized, the merchant server communicates a merchant-initiated payment request to the pavement service provider for a transaction entered into with the user. The payment service provider's server processes the payment request after verifying that processing the payment does not exceed the user-customized terms of the agreement.

Owner:PAYPAL INC

Network-based system

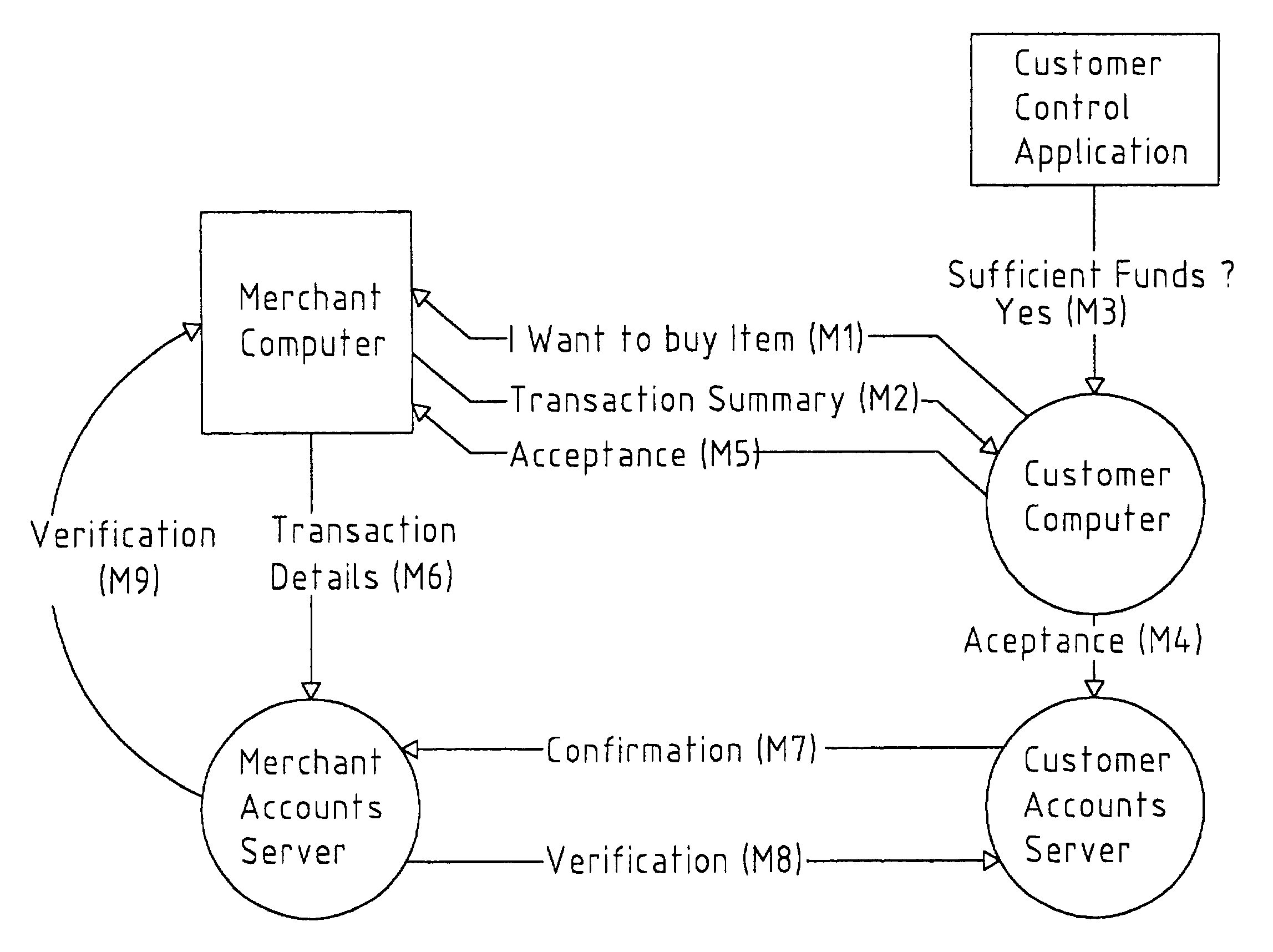

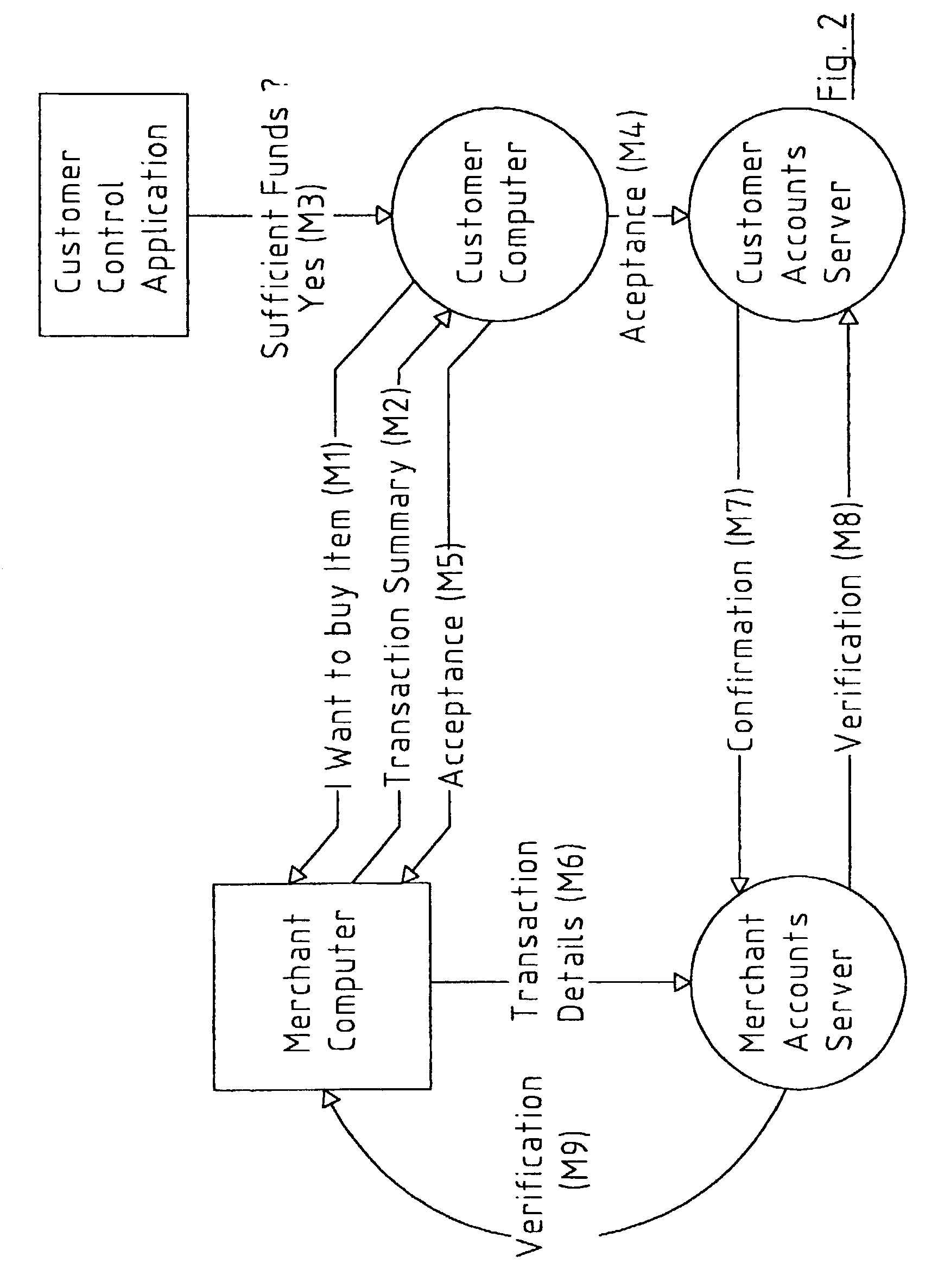

A transaction settlement system and method for internet and other trading over a telecommunications network. Customer computers and merchant computers are connected to customer account servers and merchant account servers respectively, the former maintains a customer account and conducts the financial aspects of the transaction with the merchant server without revealing the customers identity. The sequence of the messages are such that once in message M4, the customer computer instructs the customer accounts server to accept the transaction and the customer accounts server accepts it, the customer accounts server deals with the merchant accounts server to settle the account in accordance with agreed procedures. The merchant can have surely of payment. There is also provided methods to deliver coupons, e.g. discount coupons and to ship goods with anonymity.

Owner:INTERNET PAYMENTS PATENTS

Authorisation system

InactiveUS20050262026A1More securityEasy constructionDigital data processing detailsSpecial data processing applicationsHash functionTime limit

Systems and methods for securely authorising an on-line transaction, e.g. involving a micro-payment, between a customer browser and merchant server without the need for special software installed on the customer computer or a SSL connection to the merchant server. The authorisation method involves a double redirection instruction: the initial transaction request is redirected via the customer web browser to a service provider arranged to authenticate the customer, from where the authenticated instruction is further redirected via the customer web browser to a merchant site to complete the transaction. Information identifying the merchant, merchandise, etc. is included in the redirection instruction, and may be encrypted or encoded e.g. using a hash function to prevent tampering. To authorise an authenticated instruction, a cookie containing transaction identification data may be returned to the merchant web server along with the authenticated instruction. Alternatively, the service provider may set a time limit after which the authenticated instruction will no longer be valid.

Owner:WATKINS DANIEL ROBERT

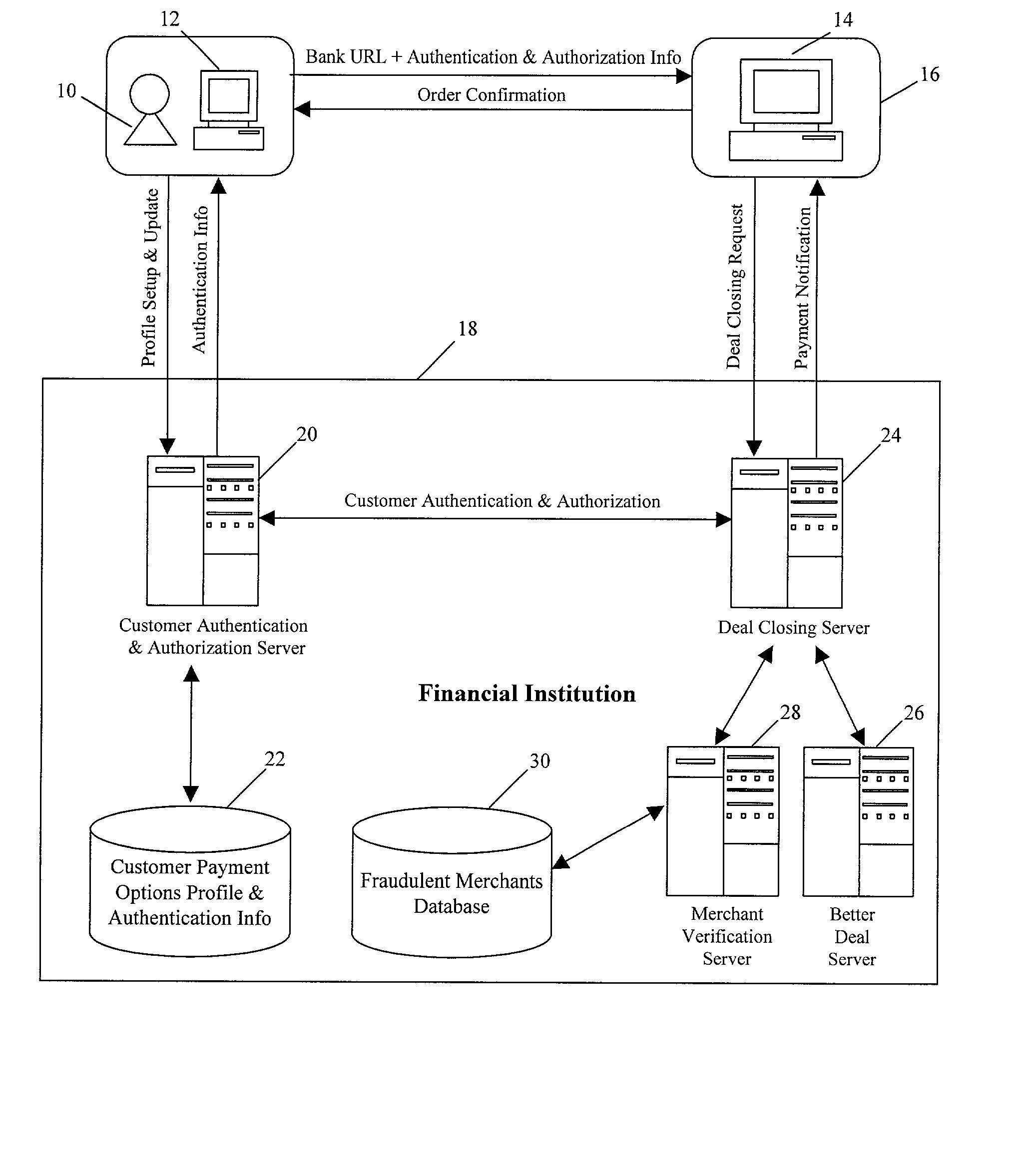

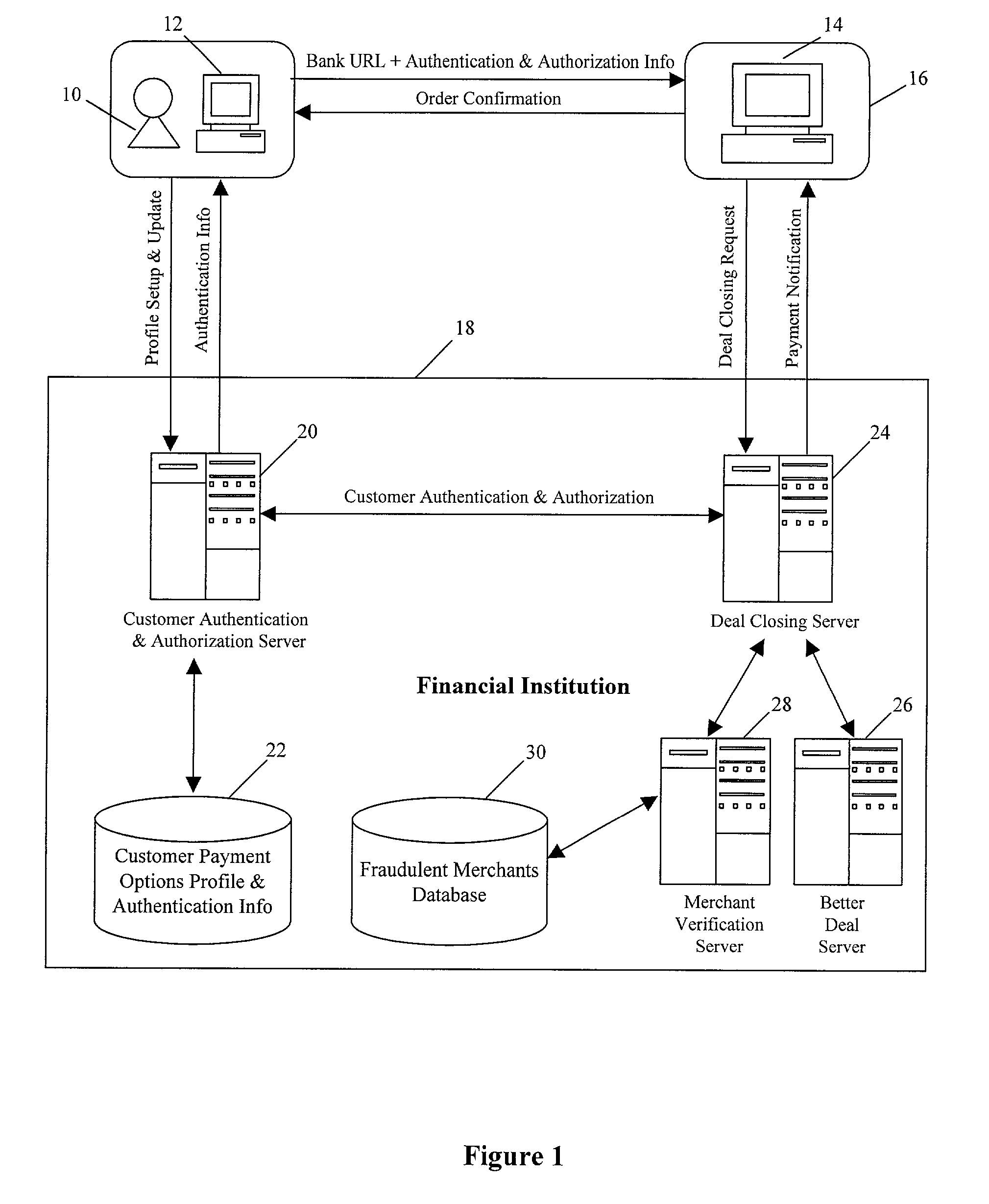

Method and system for facilitating secure customer financial transactions over an open network

InactiveUS20020128981A1Minimize involvementMinimize the customer's involvement in the transaction processPayment circuitsSpecial data processing applicationsCredit cardMerchant services

A method and system for facilitating a secure financial transaction for a user over an open network eliminates a requirement for the customer's sensitive financial information, such as credit card or debit account information, to be provided to a merchant in a recognizable form in a transaction. Instead, the merchant provides the merchant's financial information to the customer's financial institution through the customer or directly. The customer either attaches instructions for payment to the merchant's information prior to forwarding it to the customer's financial institution or sends instructions for payment directly to the customer's financial institution. Alternatively, the customer's financial information passes through the merchant server on its way to the customer's financial institution but is transparent to the merchant.

Owner:CITICORP DEV CENT INC

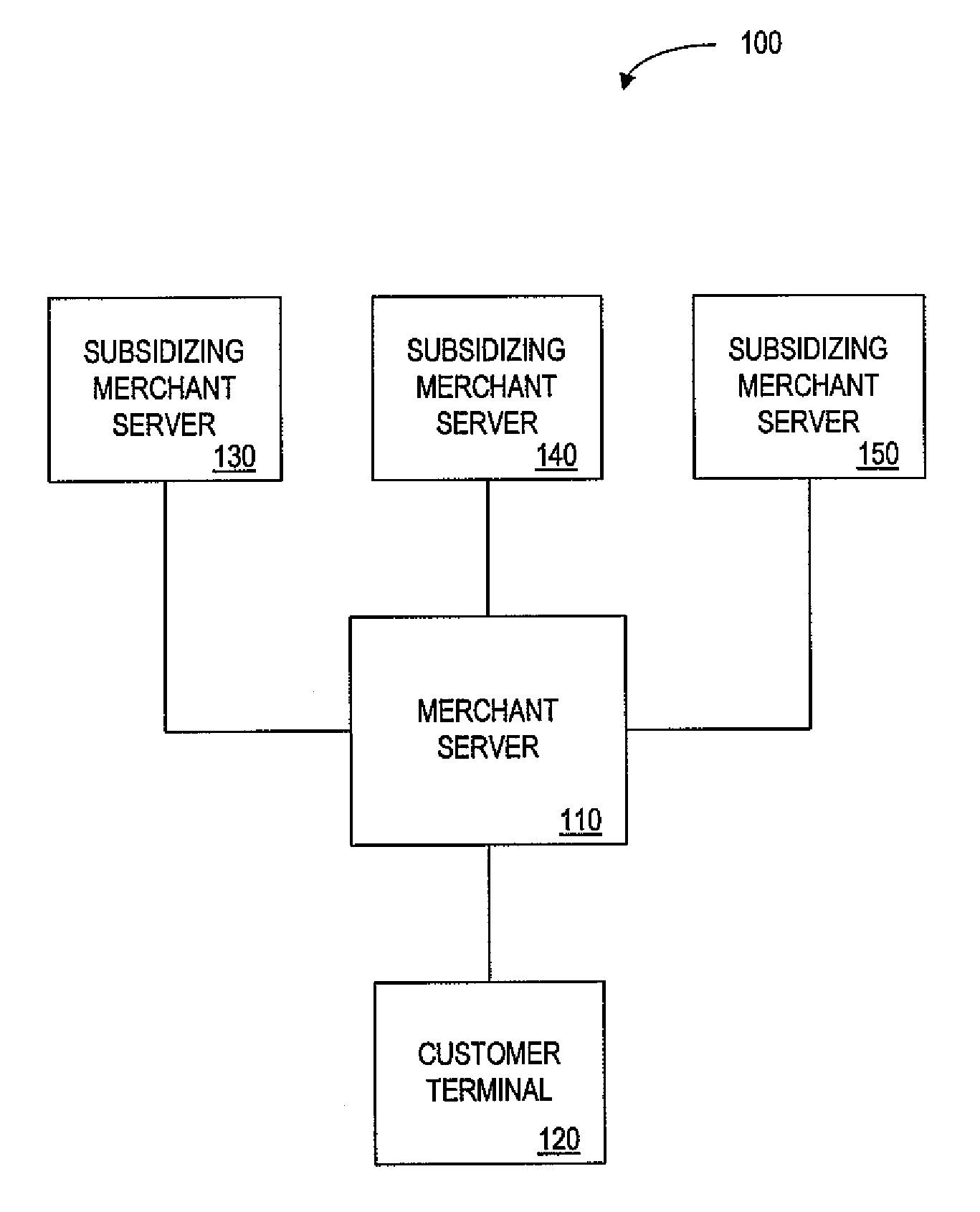

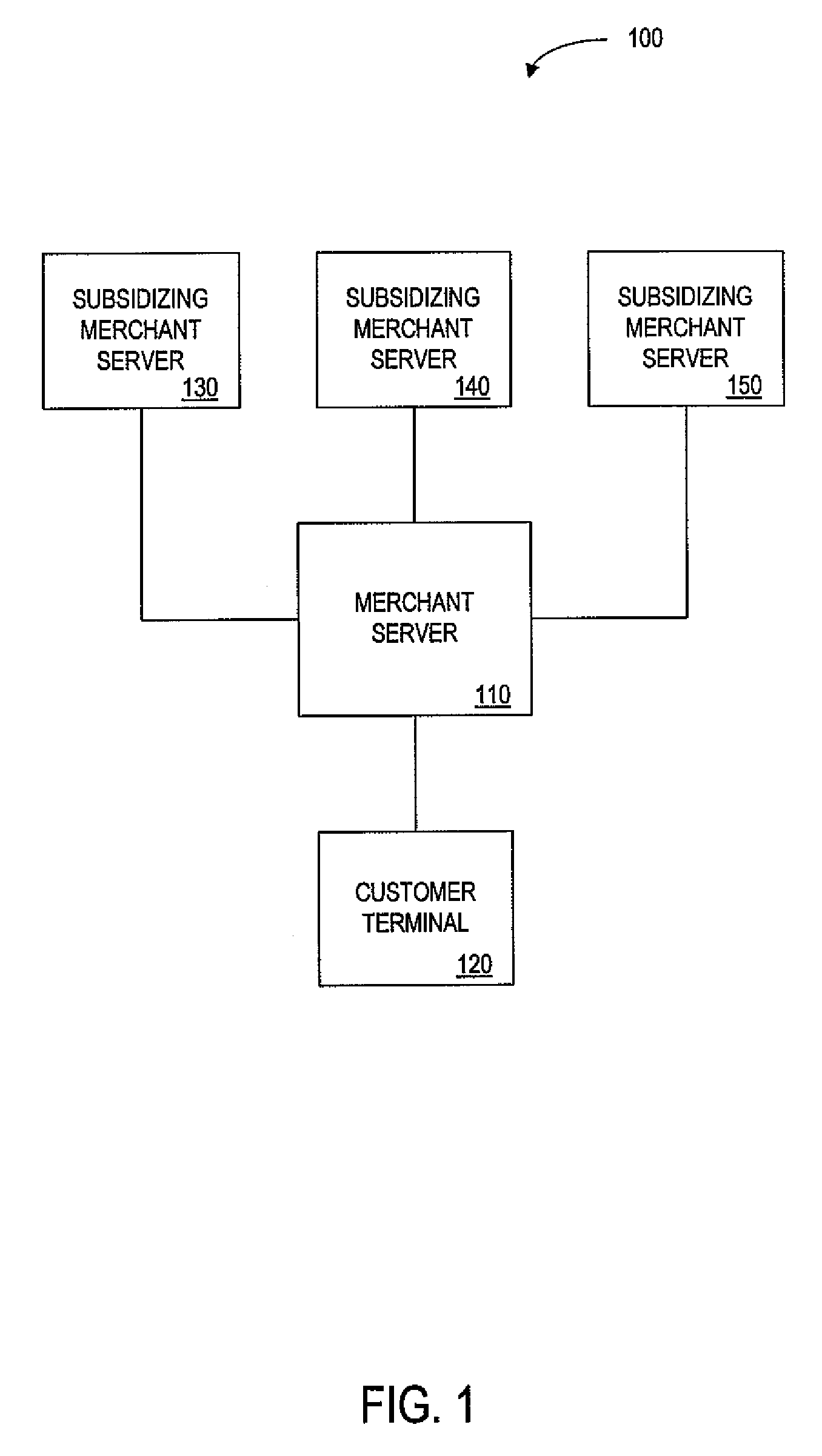

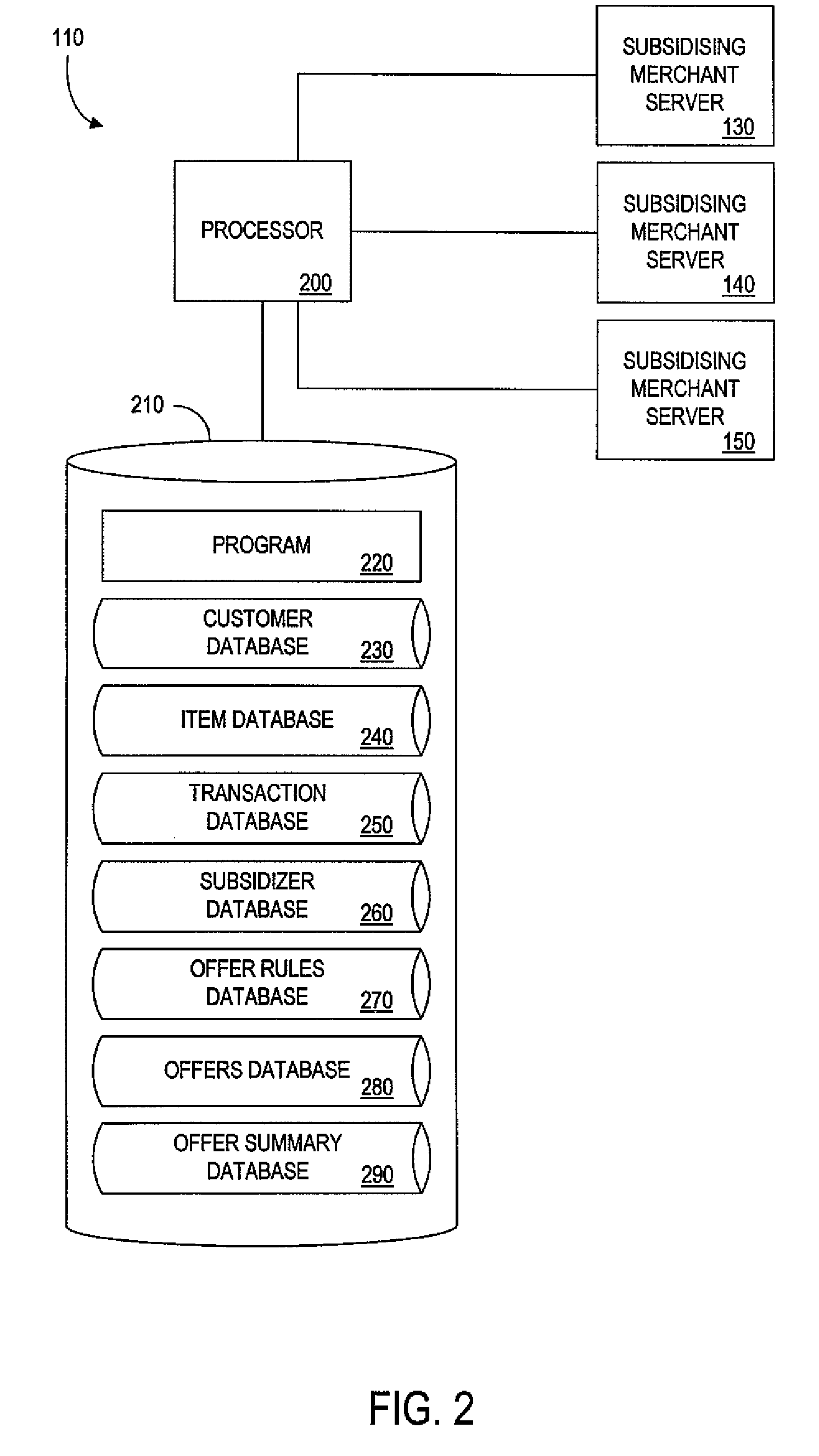

Method and apparatus for facilitating electronic commerce through providing cross-benefits during a transaction

A merchant server of a first merchant receives an indication of items that a customer is to purchase via a web site. The indication may be, for example, a signal indicating that the customer is ready to “check out” his shopping cart of items on the web site. In response, the merchant server provides an offer for a subsidy from a second merchant. The offer is provided before the items are purchased, and thus the offer is not provided unless and until the customer has manifested an intent to make a purchase from the first merchant. A response is received from the customer. If the response indicates acceptance of the offer, then the subsidy is applied to the items purchased. For example, the total price paid for the items may be reduced, or the items may even be provided to the customer without charge. In exchange, the customer agrees to participate in a transaction with the second merchant. For example, the customer may be required to switch service providers (e.g. long distance telephone service) or initiate a new service agreement (e.g. sign up for a credit card account).

Owner:PAYPAL INC

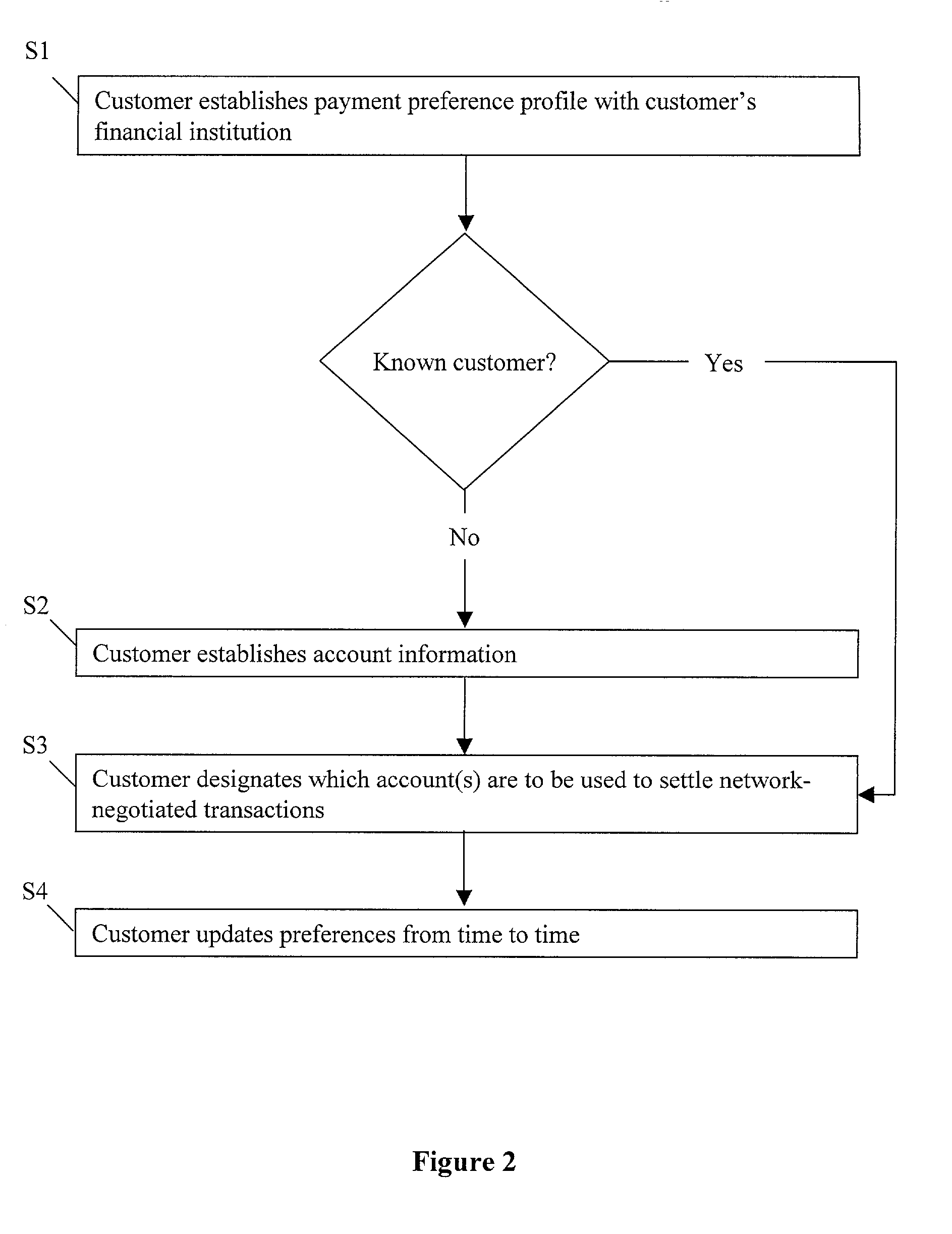

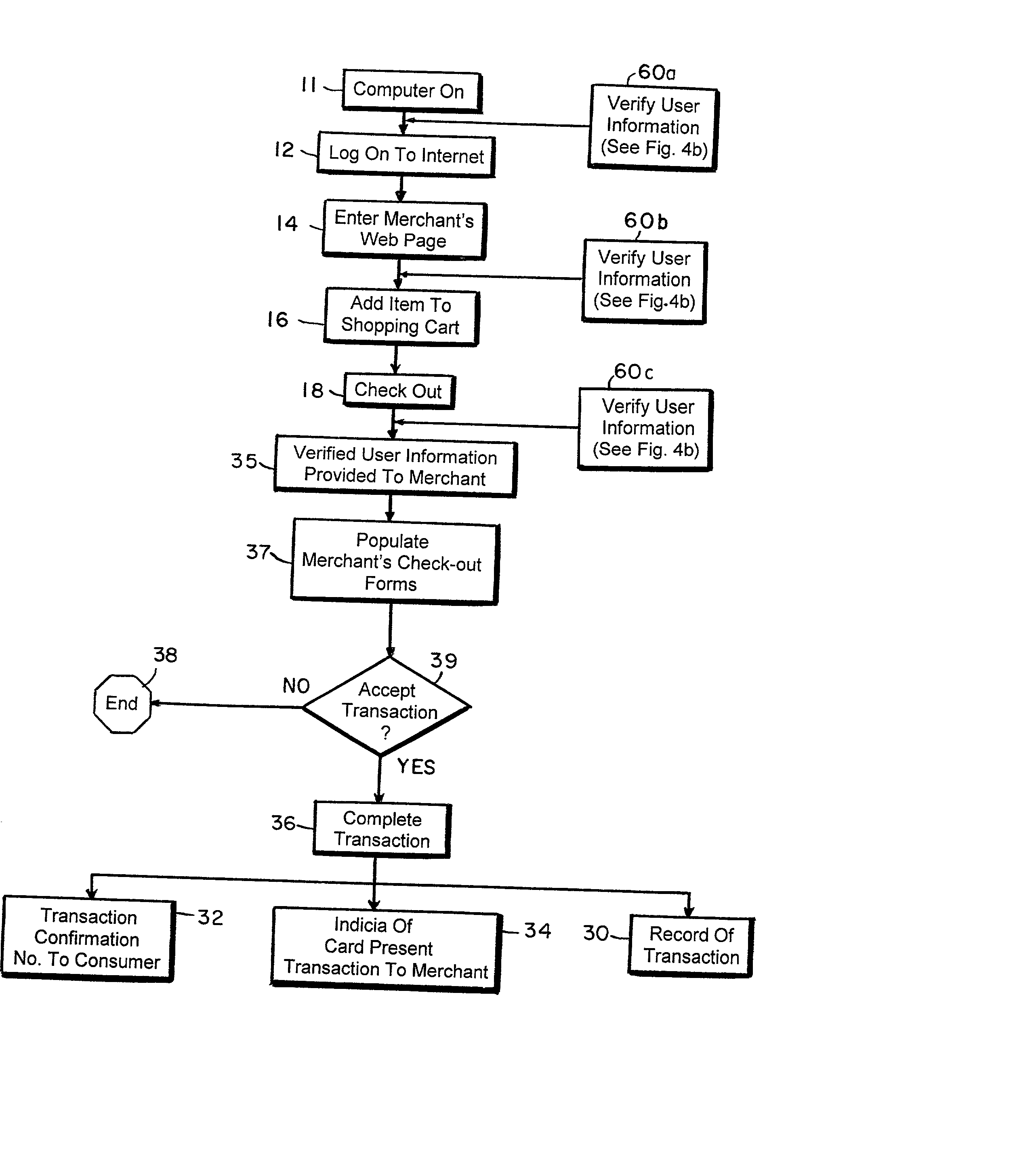

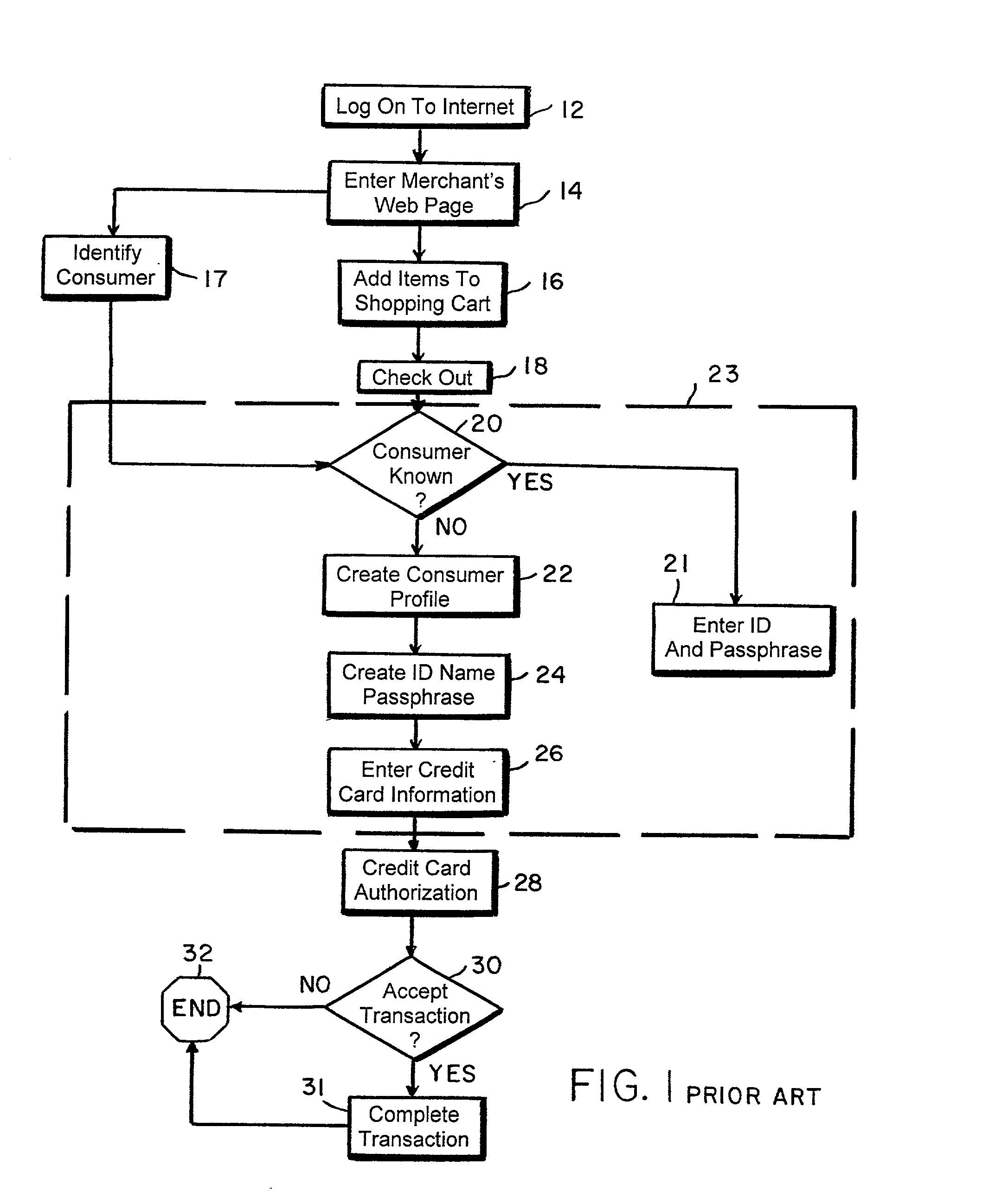

Checkout system for on-line, card present equivalent interchanges

InactiveUS20030018587A1Cash registersBuying/selling/leasing transactionsThird partyMerchant services

The present invention includes methods for providing merchant's with verified information about a user during a remote electronic transaction; methods for carrying out a verified, remote electronic transaction over a network by providing verified user information to a merchant's server, which information is necessary to complete the verified transaction; and systems enabling a user to complete a verified, remote electronic transactions over a network with a merchant, wherein the verified transactions include providing the merchant's server with verified user information. Moreover, the present invention provides methods and systems for conducting verified, remote electronic transactions using a single access code. The system comprises one or more verifying servers that are maintained by the merchant or a third party; one or more servers that are maintained by a merchant, one or more digital, electronic devices that are maintained by the user or by a third party, and a machine-readable-data structure that interfaces with said digital, electronic device. The machine-readable data structure comprises at least one internal microprocessor that controls at least one internal semiconductor memory, having a secured first portion for storing verifiable user information and an unsecured second portion. Verifiable user information about the user, which is necessary to complete a verified, card present equivalent transaction, resides in the secured first portion of the semiconductor memory. A security algorithm and a previously registered security code reside on the unsecured second portion of the semiconductor memory. The verifiable user information is provided to the merchant server or, alternately, to the verifying server after the machine-readable data structure is read and a single access code that matches the previously registered security code is provided by the user.

Owner:FLEET CREDIT CARD SERVICES

Social networking interactive shopping system

The social networking interactive shopping system includes a portable wireless user interface for use by a store customer when shopping. A merchant server is provided, the server having market survey, advertising, promotions, security, social networking services, web server capability, a quantitative prediction modeling system predicting behavior of the customer, a predictive response marketing / advertising system that targets advertising messages to the customer based on a predicted customer response to the advertising messages, and payment application software. The merchant server is capable of wired or wireless communication with the portable wireless user interface. A database is provided, and can be stored on site or off site. The database includes information associated with items for sale at the store, and is in operable communication with the merchant server. Using the portable wireless user interface, the store customer can purchase user selected store items thereby obviating necessity for travel through a store check-out line.

Owner:RAIMBEAULT SEAN M

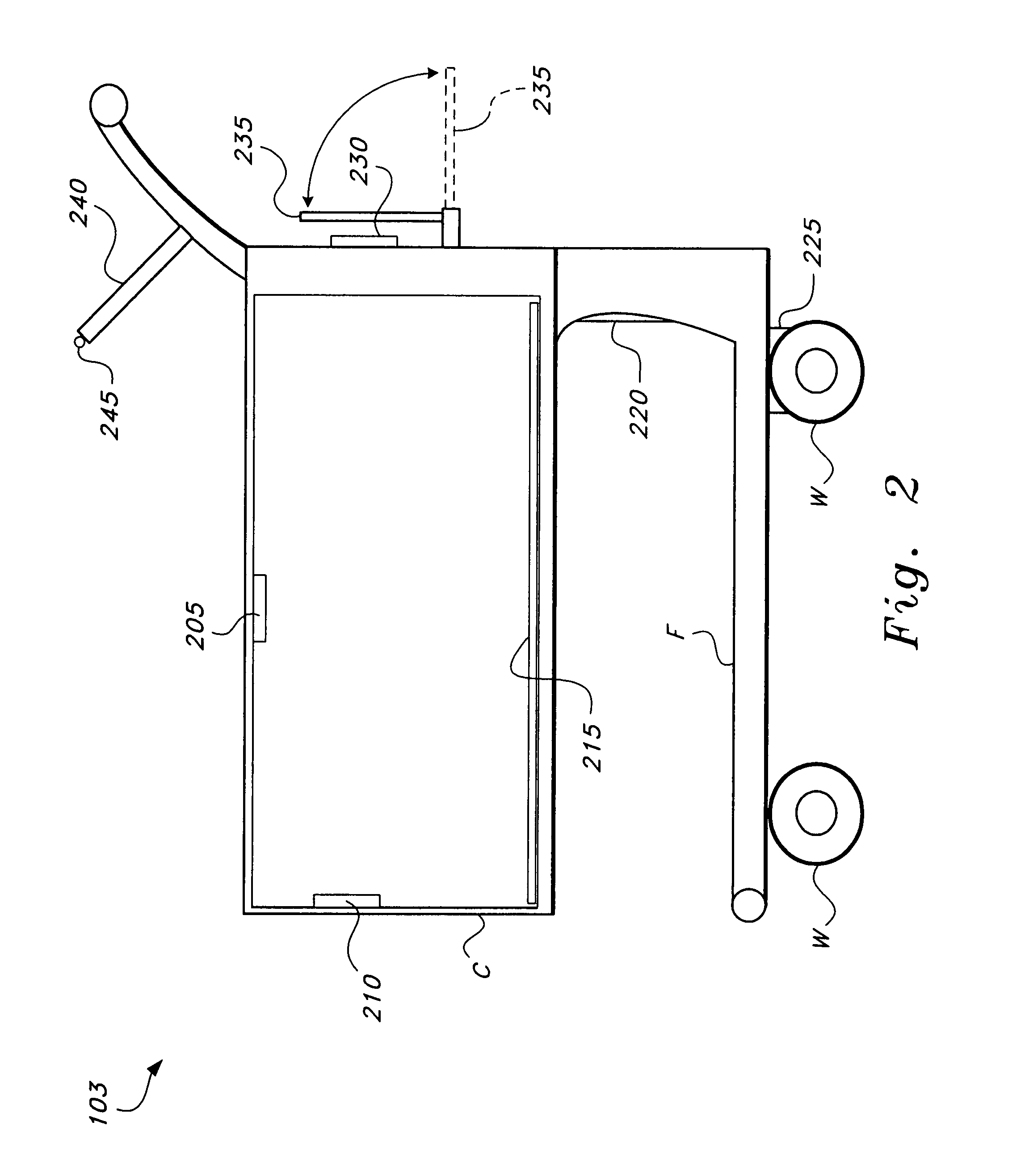

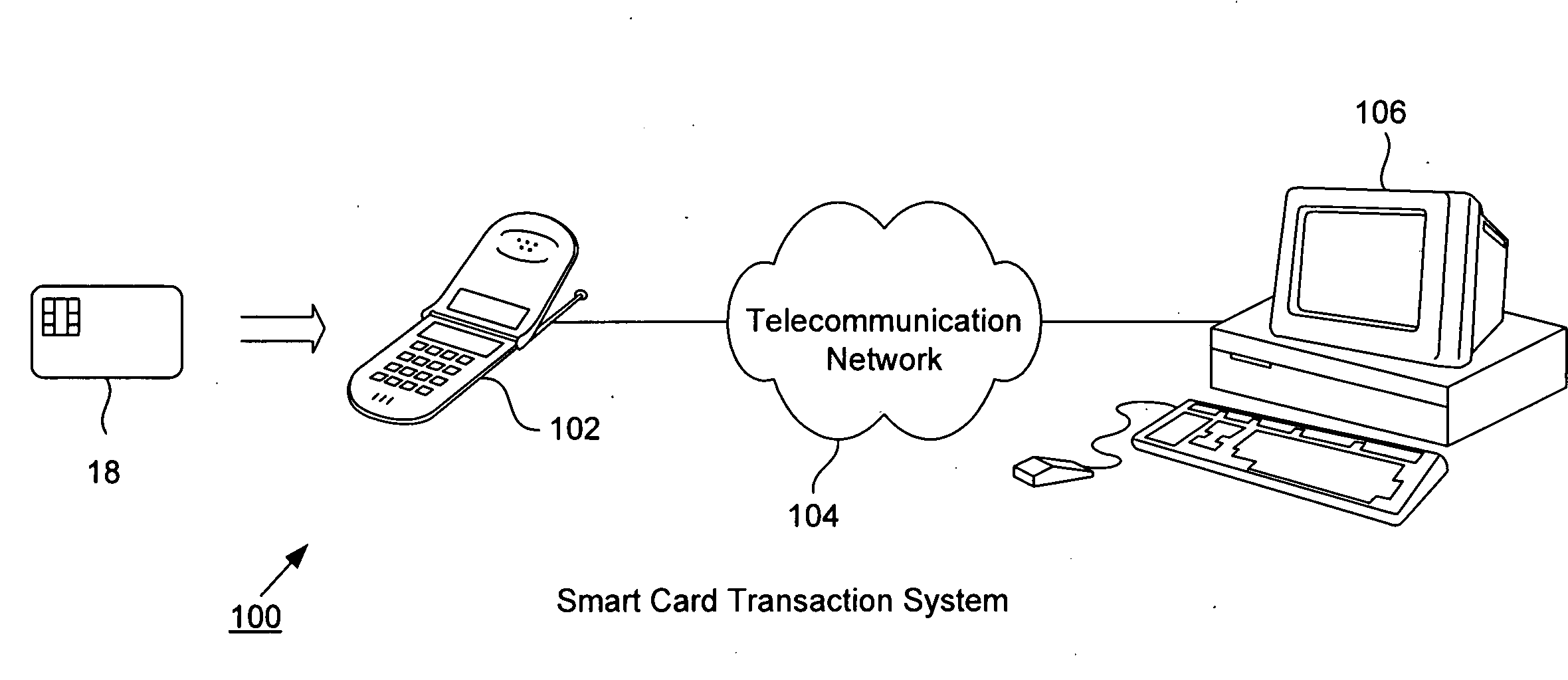

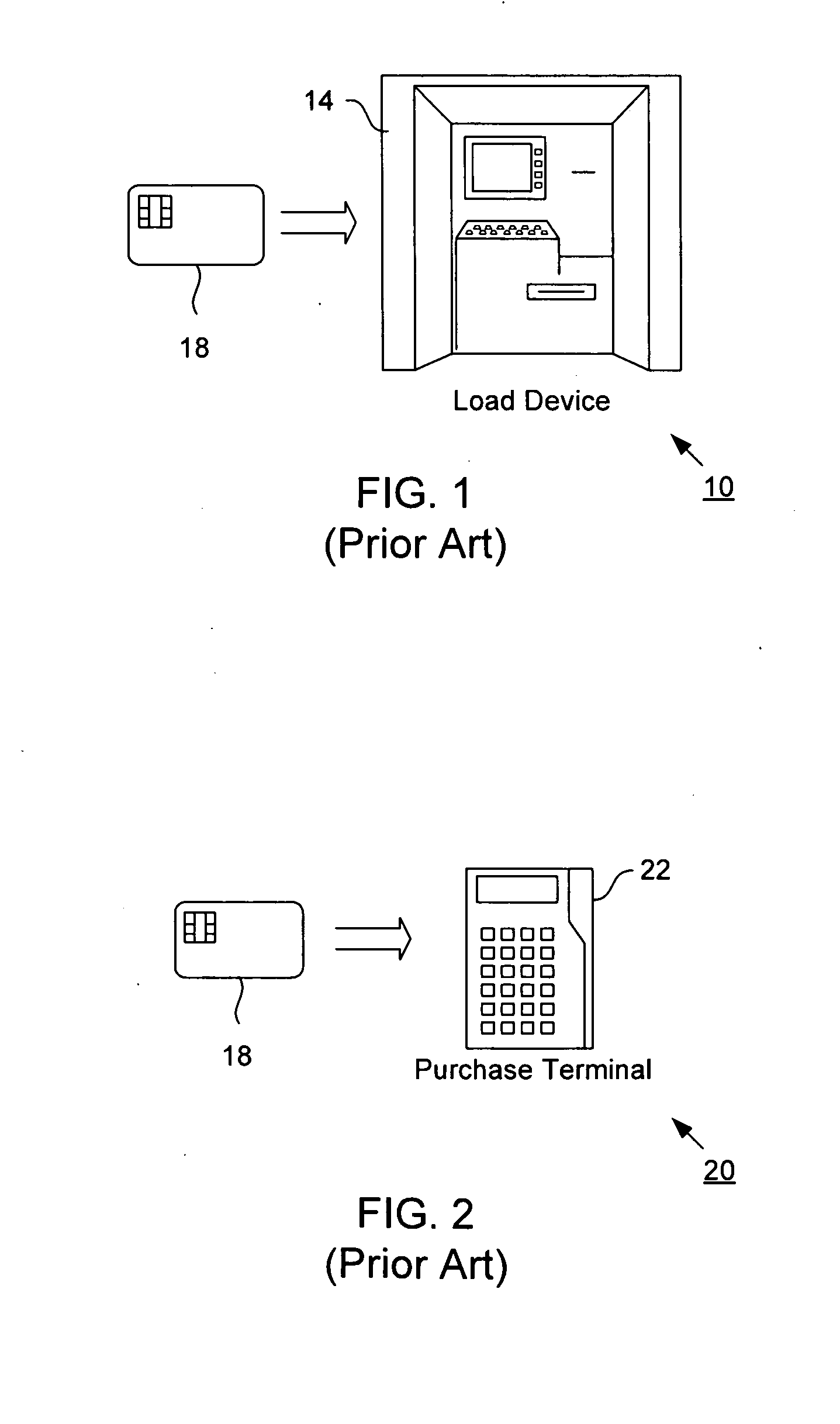

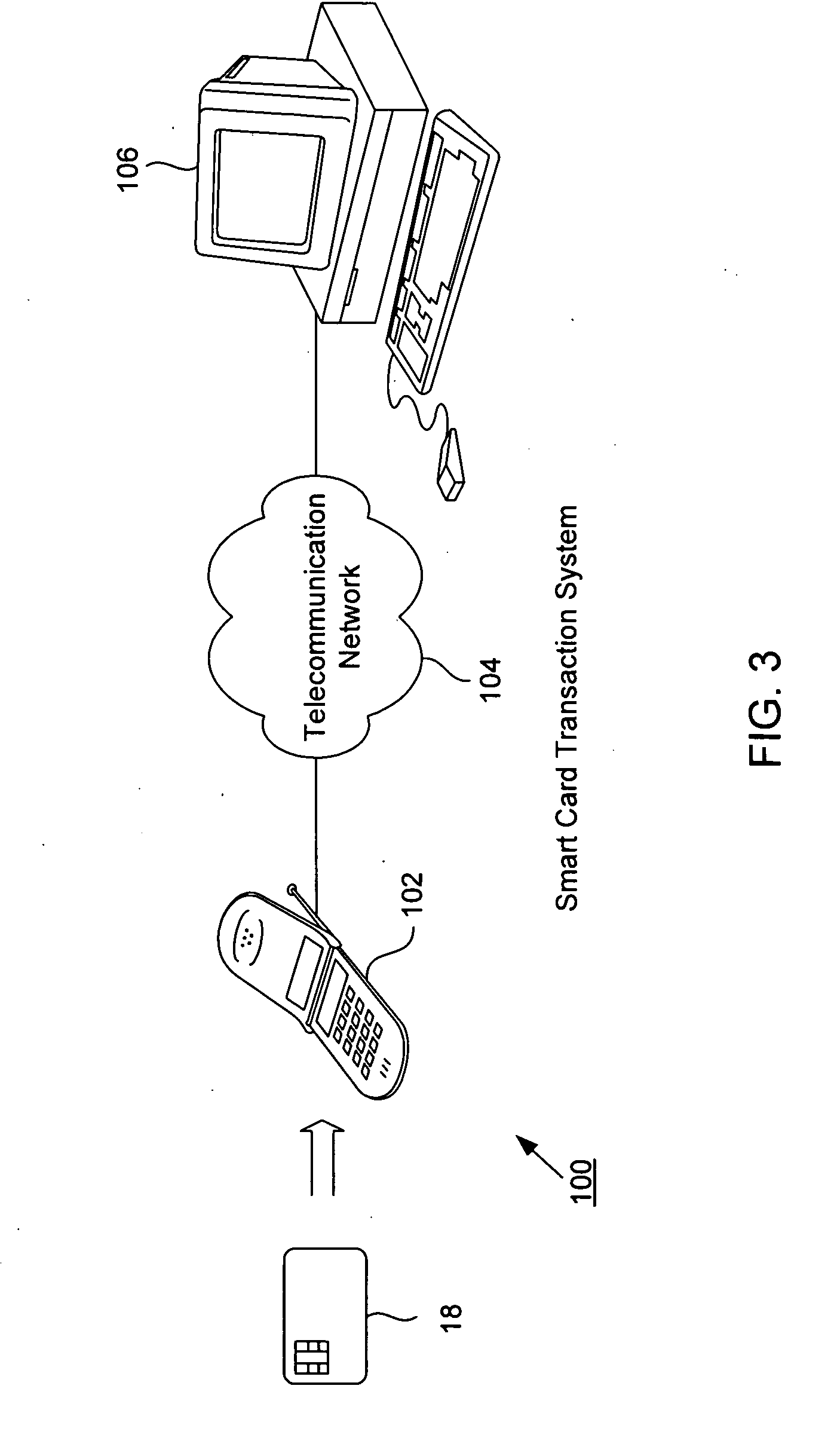

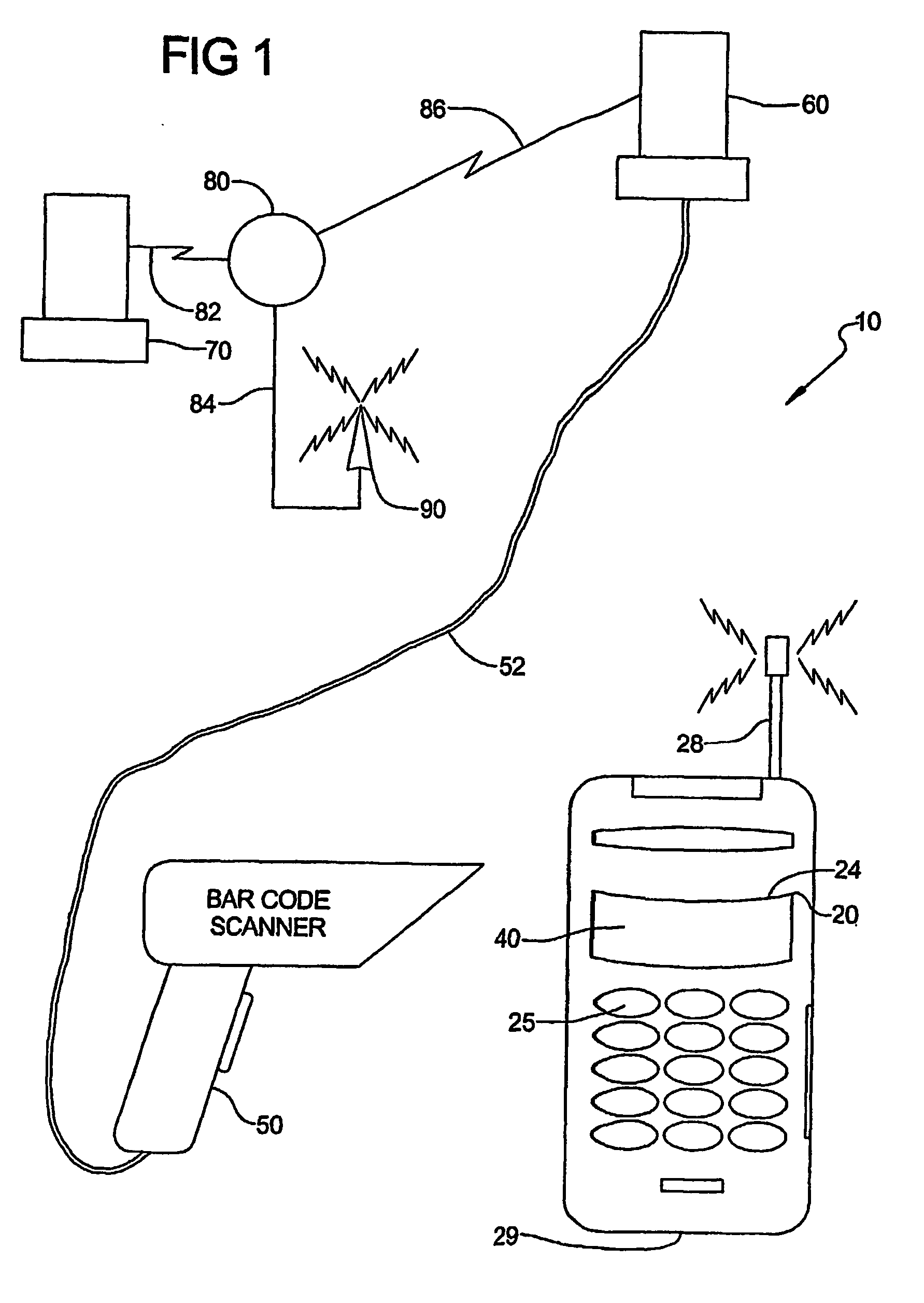

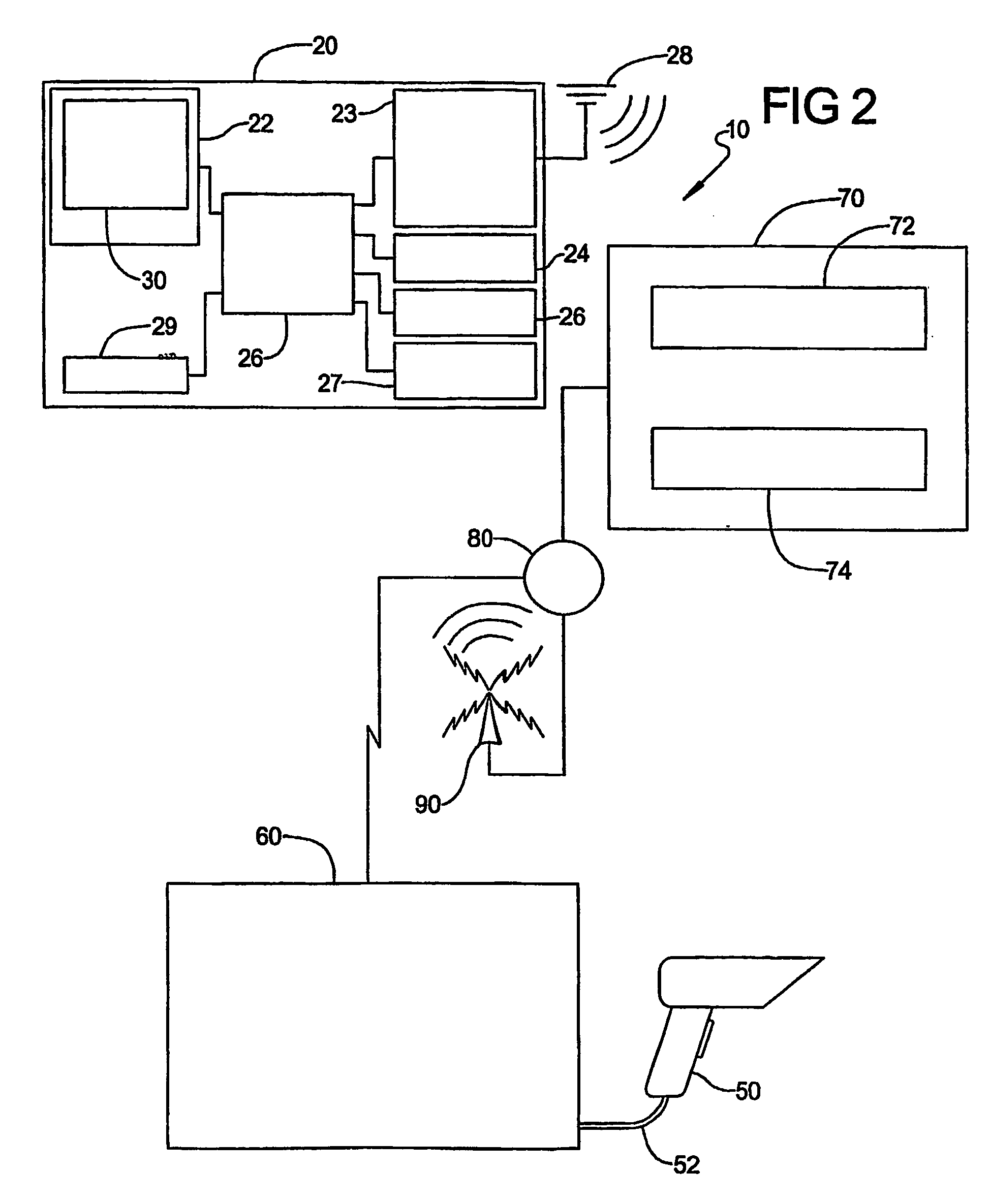

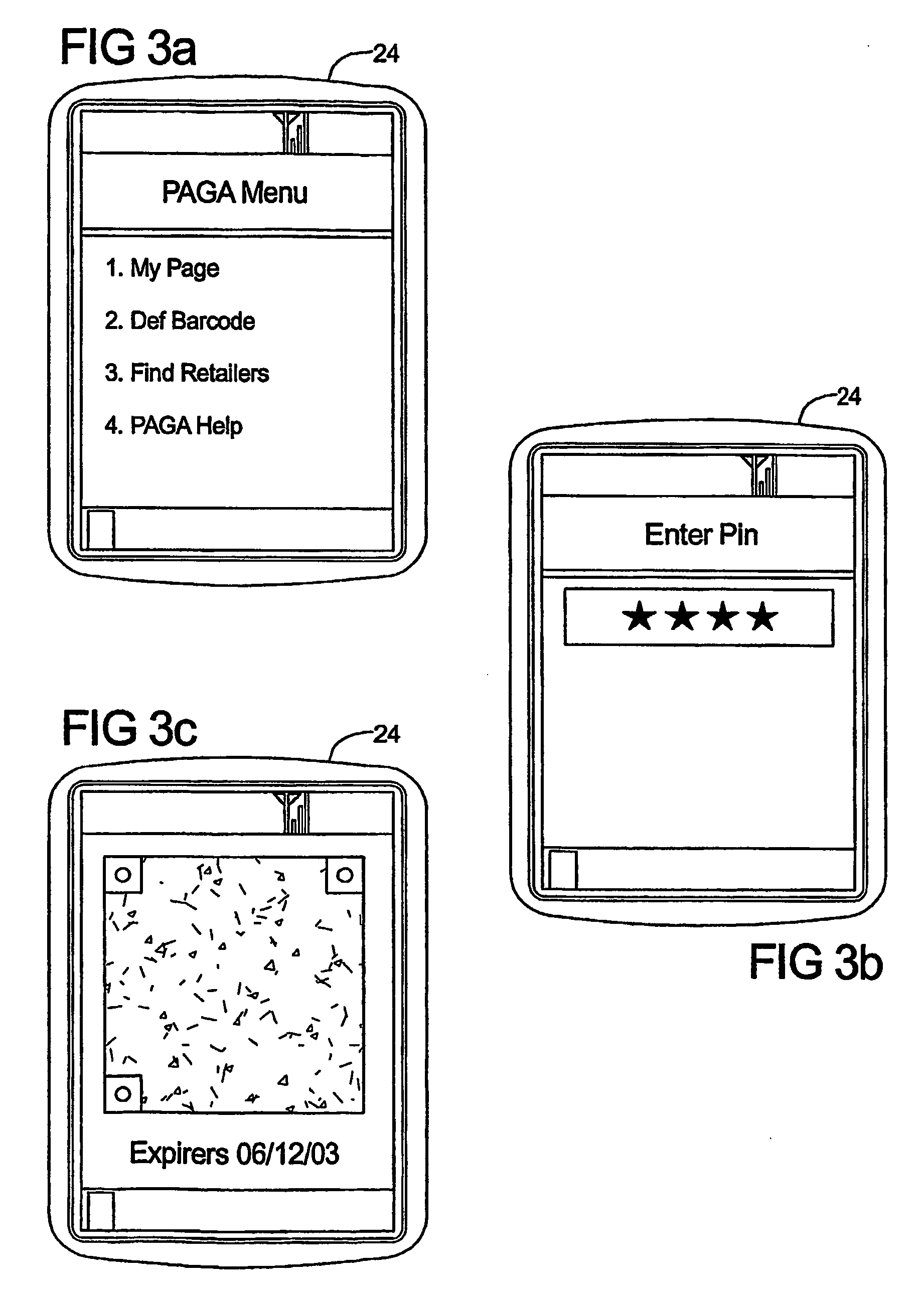

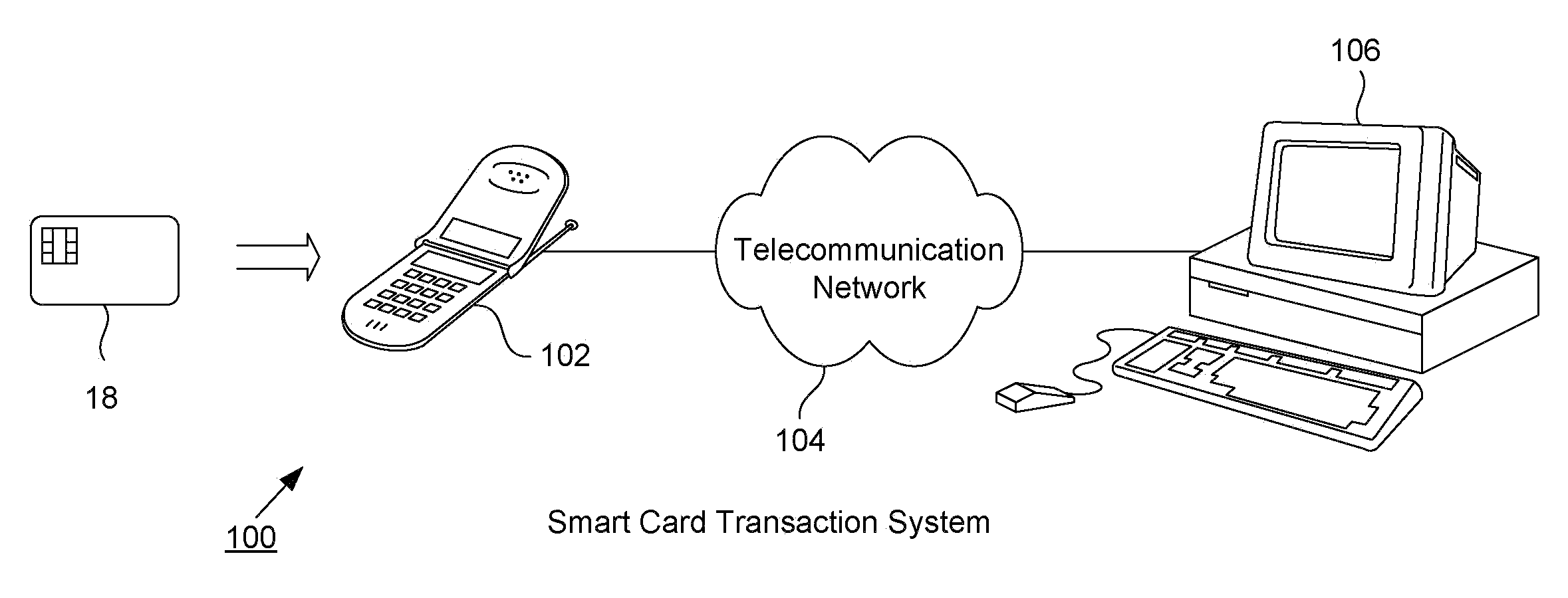

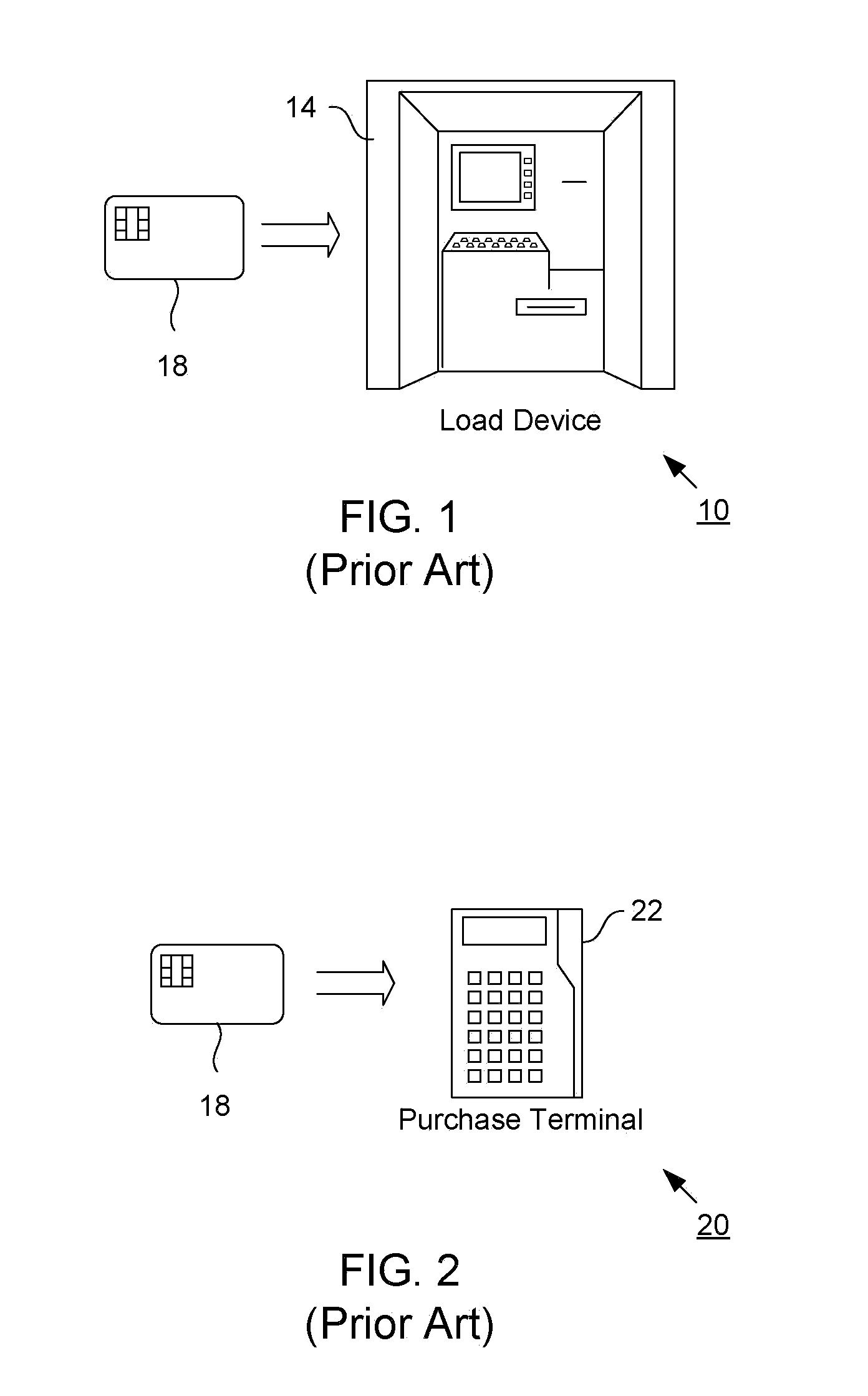

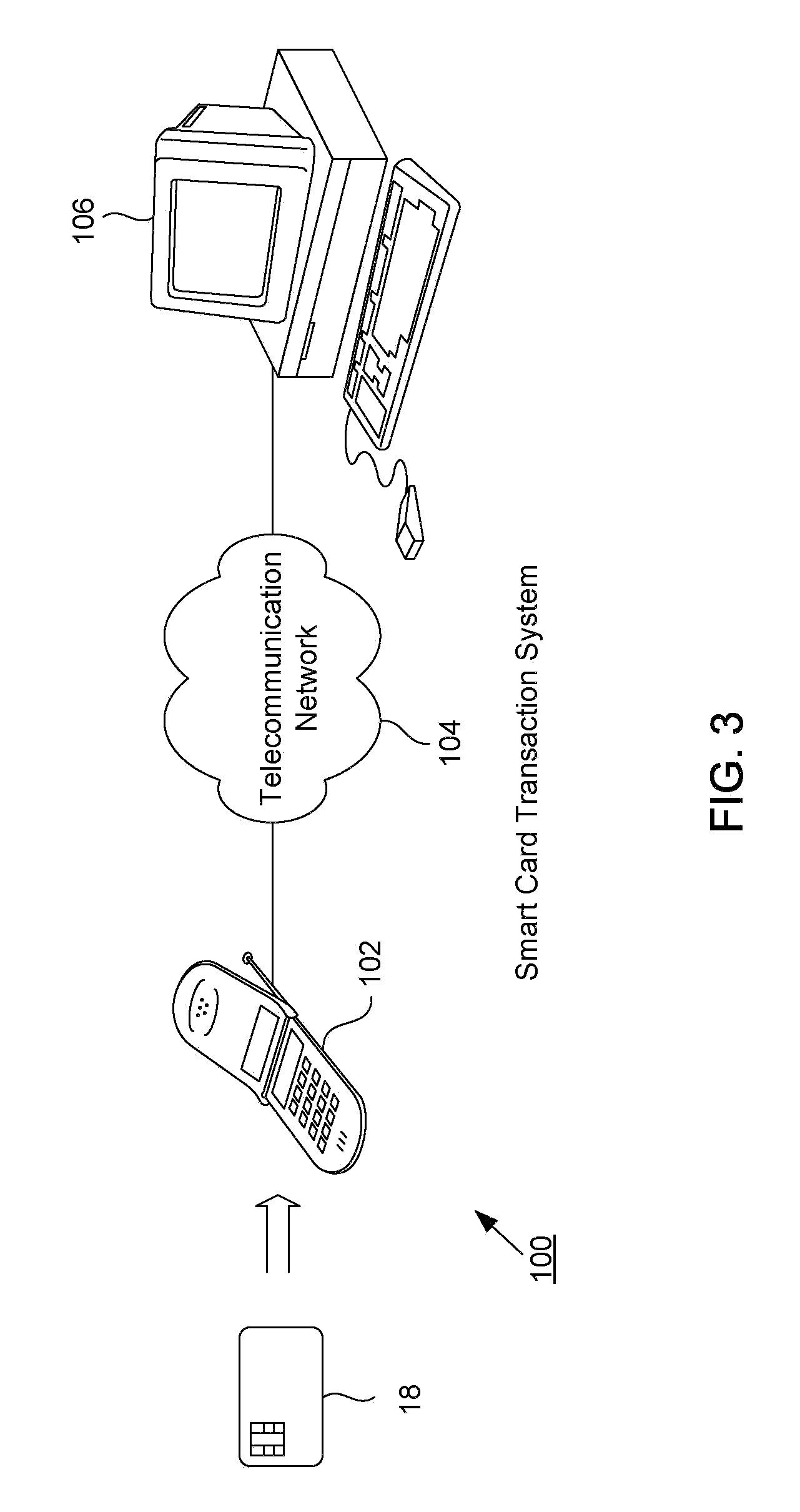

Smart card load and purchase transactions using wireless telecommunications network

InactiveUS20090030843A1Enhanced anonymityPrivacy protectionFinanceMultiple keys/algorithms usagePaymentMerchant services

A smart card transaction allows a consumer to load value onto a smart card and to make purchases using a smart card with a mobile telephone handset over the telecommunications network. For loading, the system includes: a mobile telephone handset including a card reader; a gateway computer; a funds issuer computer; and an authentication computer. The mobile telephone handset receives a request from a user to load a value onto the smart card. The handset generates a funds request message which includes the value and sends the funds request message to a funds issuer computer. The funds issuer computer debits an account associated with the user. Next, the handset generates a load request message with a cryptographic signature and sends the load request message to an authentication computer which authenticates the smart card. The handset receives a response message which includes a cryptographic signature and an approval to load. Finally, the handset validates the second cryptographic signature and loads the value onto the smart card. For payment, the system includes a merchant server and a payment server. First, the handset sends an order request message to the merchant server computer, and in return receives a purchase instruction message. The handset processes the purchase instruction message locally, and then sends a draw request message to a payment server computer. The payment server computer sends a debit message which includes a cryptographic signature and an approval to debit the smart card. Finally, the handset validates the cryptographic signature and debits the smart card.

Owner:VISA INT SERVICE ASSOC

Mobile electronic transaction system, device and method therefor

InactiveUS20060080111A1Cash registersBuying/selling/leasing transactionsMerchant servicesComputer science

Disclosed herein as a system, device and method for conducting electronic transactions utilizing a wireless communications device adapted to receive a transaction program and data. The device comprises memory storage for storing a transaction program, a microprocessor and a display screen. The microprocessor executes instructions contained within the transaction program produces indicia representative of value, where value is selected from the group consisting an identifier of a purchased good, an identifier of a purchased service, a coupon, a discount, a prepaid transaction, an electronic negotiable instrument, a sum from a credit account, and a sum from a debit account. The indicia is readable by a scanner in communication with a merchant server, where the merchant server is adapted to access a provider server for storing and retrieving user account information.

Owner:VAGUE PROTOCOL

Smart card transactions using wireless telecommunications network

InactiveUS7729986B1Simple, easy-to-use, portableIncrease valueFinanceCryptography processingMerchant servicesPayment

Owner:VISA INT SERVICE ASSOC

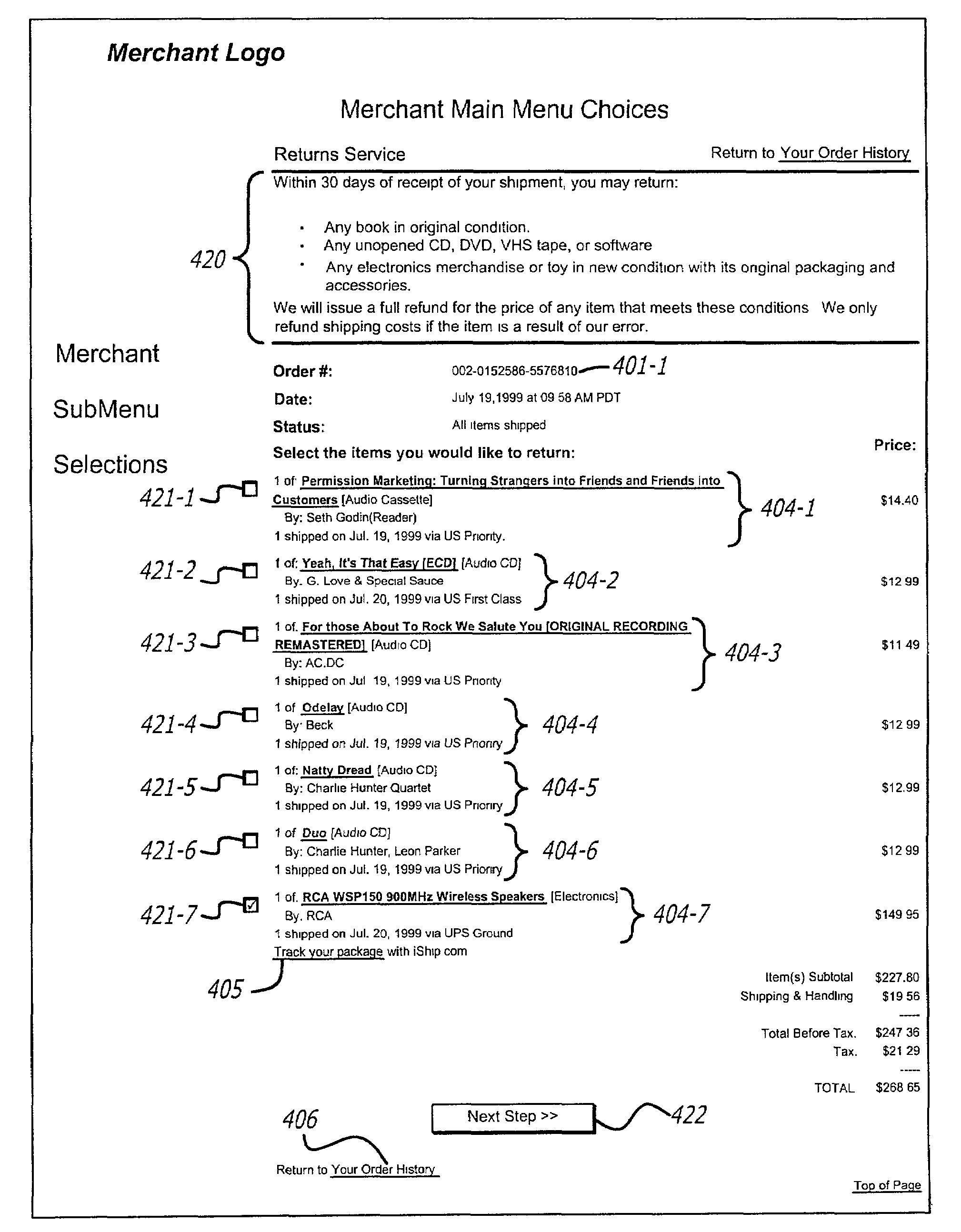

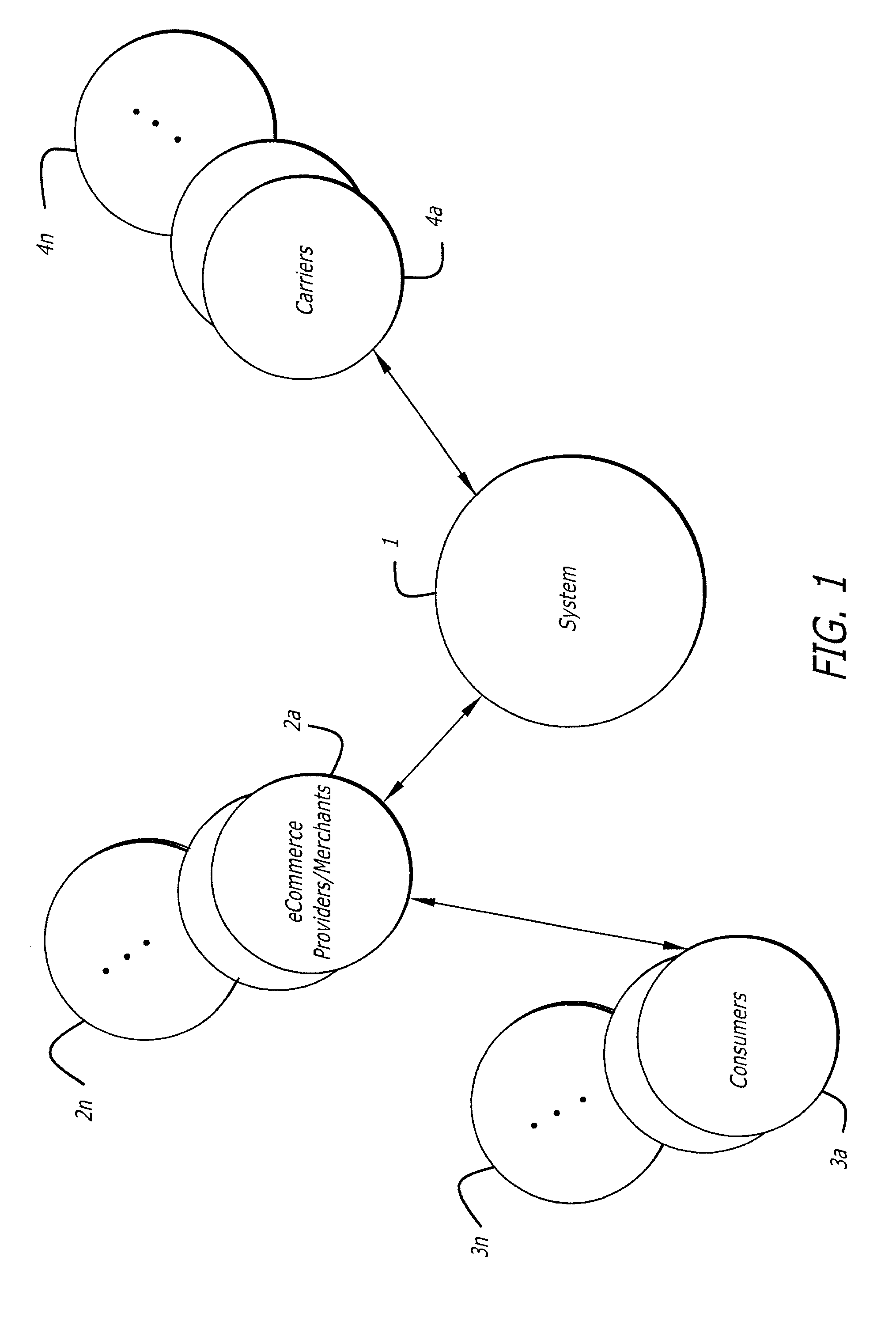

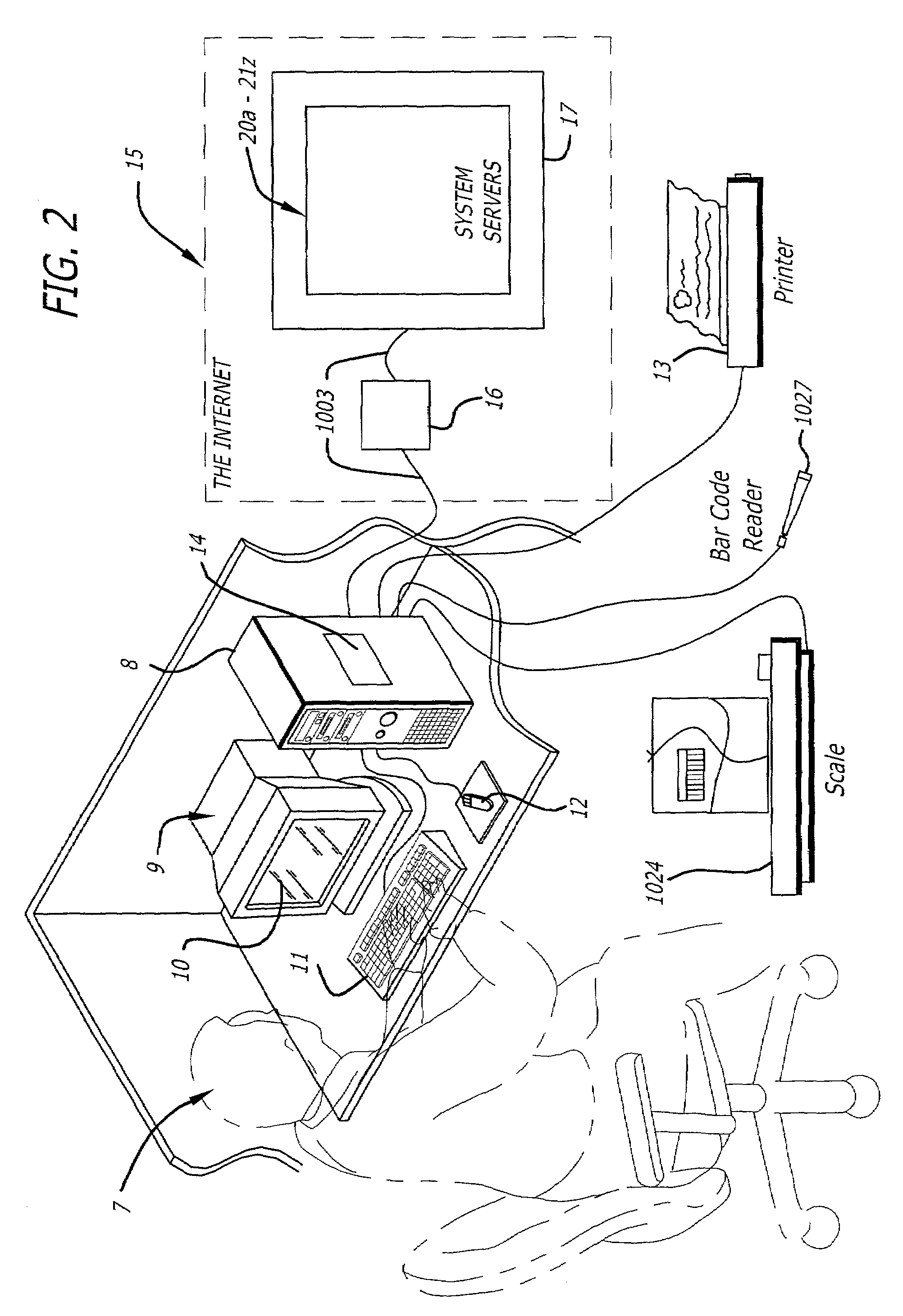

Apparatus, systems and methods for online, multi-parcel, multi-carrier, multi-service parcel returns shipping management

ActiveUS7660721B2The process is simple and convenientStacking articlesLogisticsMerchant servicesComputerized system

The present invention provides a computer system (the “System”, or the “Return System”) that is configured and programmed to provide online stores with a fast, simple, convenient way for eCommerce customers of an online store to return merchandise purchased from that store from within that online store. The Return System provides multi-carrier shipment rating, shipment labeling, shipment tracking, shipment tracking management reports, returns analysis and returns management reporting In an exemplary embodiment, the Return System has three major components: 1.) A Returns Manager Subsystem that provides a user interface to each Merchant to setup the Merchant's account, setup the Merchant's return policy and rules, and to monitor the status and movement of return shipments; 2.) A Consumer Returns Subsystem (also sometimes referred to as a “Customer Returns Subsystem”) that provides each consumer using the Returns System with an online user interface that leads the consumer through the returns process, displays the return policies and rules to the consumer, provides shipping document to ship the return package if appropriate, and permits the consumer to track their return shipments; and 3.) a Returns Processing Subsystem that, in the exemplary embodiment, provides background shipping and tracking functionality. In one exemplary embodiment of the present invention, the Online Merchant integrates the Merchant's online system with the Returns Processing Subsystem. In another exemplary embodiment, the Returns Processing Subsystem is provided as an independent web-based application service (referred to as a “Return Merchant Service System”) operated by a common provider. In such an embodiment, the Merchant's system interacts with the Return Merchant Service System through Application Program Interfaces (“API”).

Owner:ISHIP +1

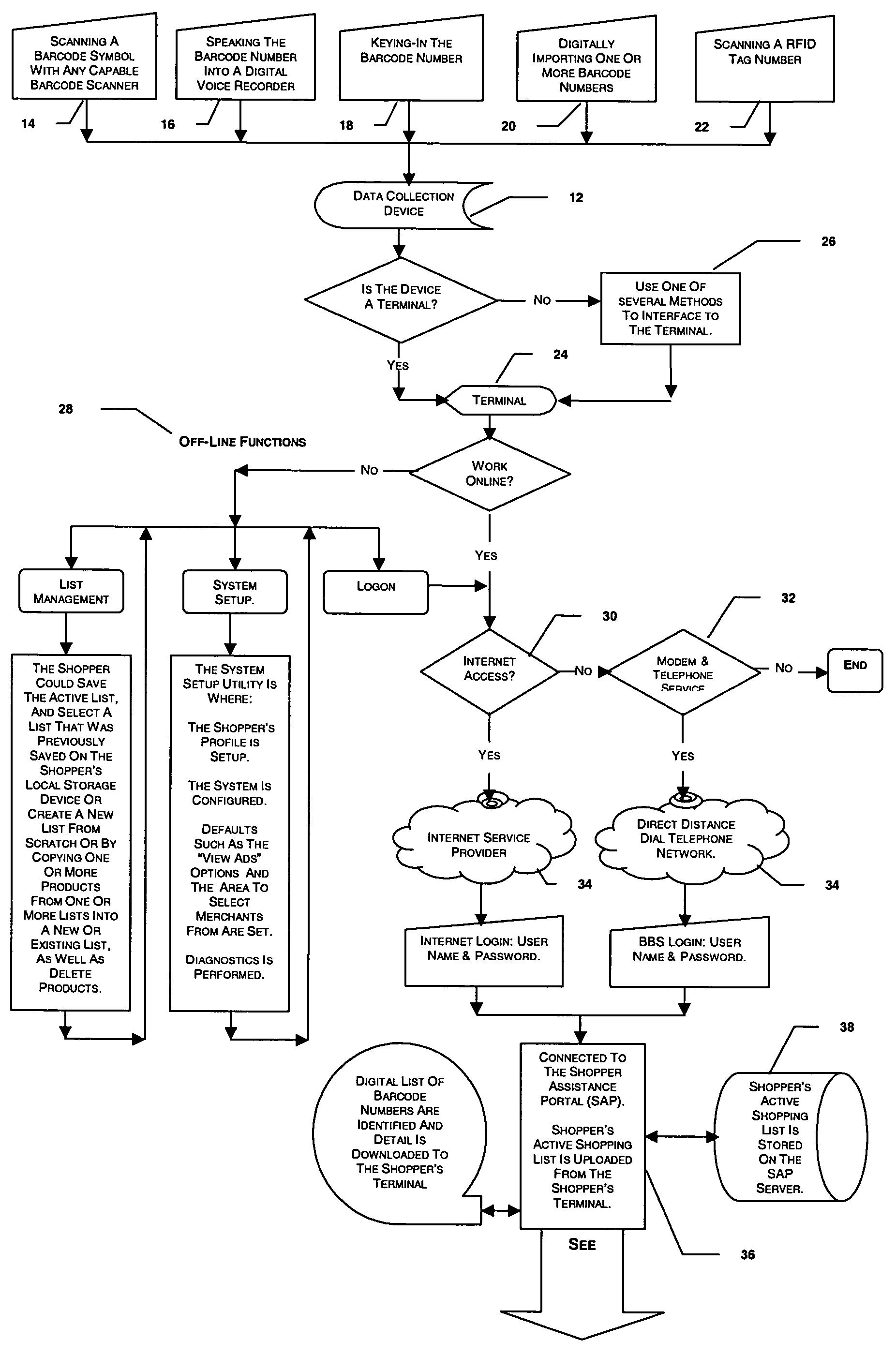

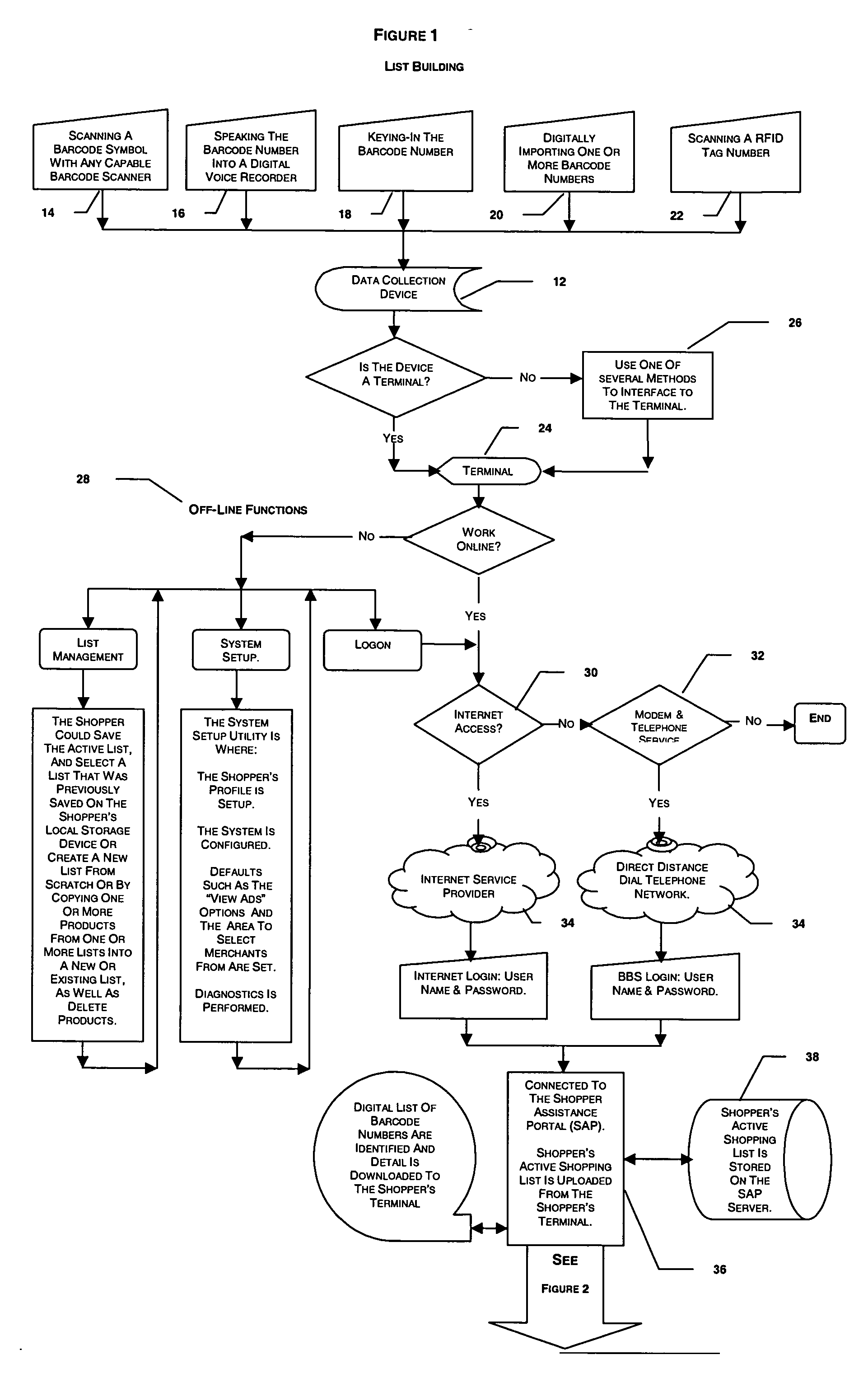

Remote shopping system with integrated product specific advertising

InactiveUS20050075940A1Enhance existing and future e-commerce merchantsSpecial data processing applicationsMarketingMerchant servicesData pack

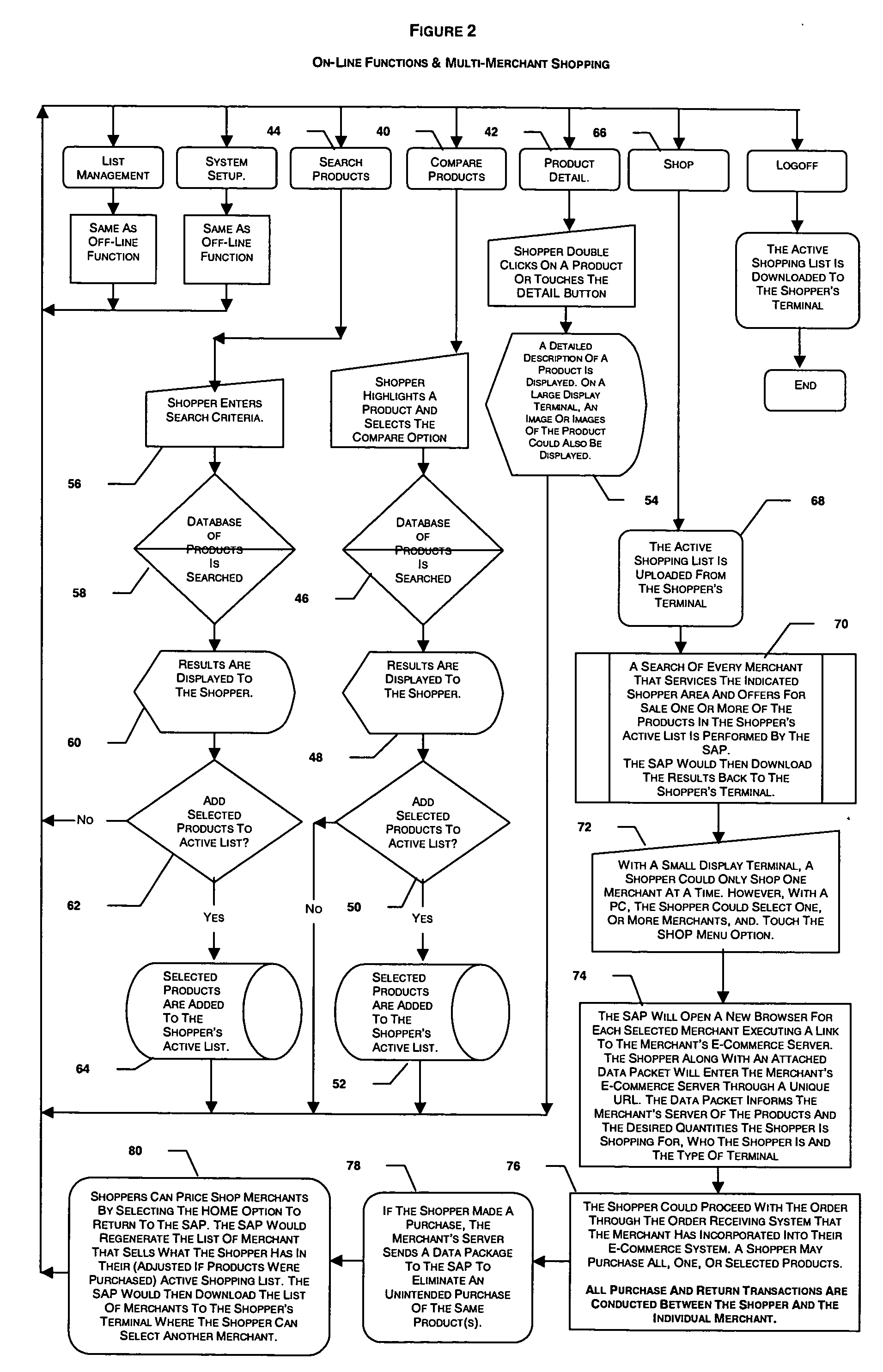

A method and system for remotely building a shopping list for remote shopping and ordering merchandise electronically. A shopping list can be built any time, anywhere by scanning, speaking, or keying-in barcode numbers such as UPC codes into a data collection device that can be an intricate part of the terminal or interfaced to the terminal The terminal is used for ordering merchandise through a direct distance dial or wireless telephone network, that could utilize or connect to the Internet, to connect to a shopper assistance portal that maintains information relating to a plurality of merchants and a plurality of product offered by the plurality of merchants. The merchandise is identified by barcode numbers in the form of individual digital merchandise codes. The geographical location of order placement can be configured by the user to select only merchants that service the location. When a shopper selects a merchant, a link is executed to the merchant's e-commerce server where the shopper could proceed with the order through the order receiving system that the merchant has incorporated into their e-commerce system. A shopper may purchase all, one, or selected products. Purchases and return transactions are preferably conducted between the shopper and the individual merchant. The targeted product specific advertising program searches the shopper's list for specific products that a shopper in the merchant's service area is planning to buy. Ads are displayed on the terminal relevant to items that match specific barcode numbers. If the shopper clicks through on the ad, the shopper will enter the merchant's site through a special URL along with their active shopping list in an attached data packet.

Owner:DEANGELIS LAWRENCE J

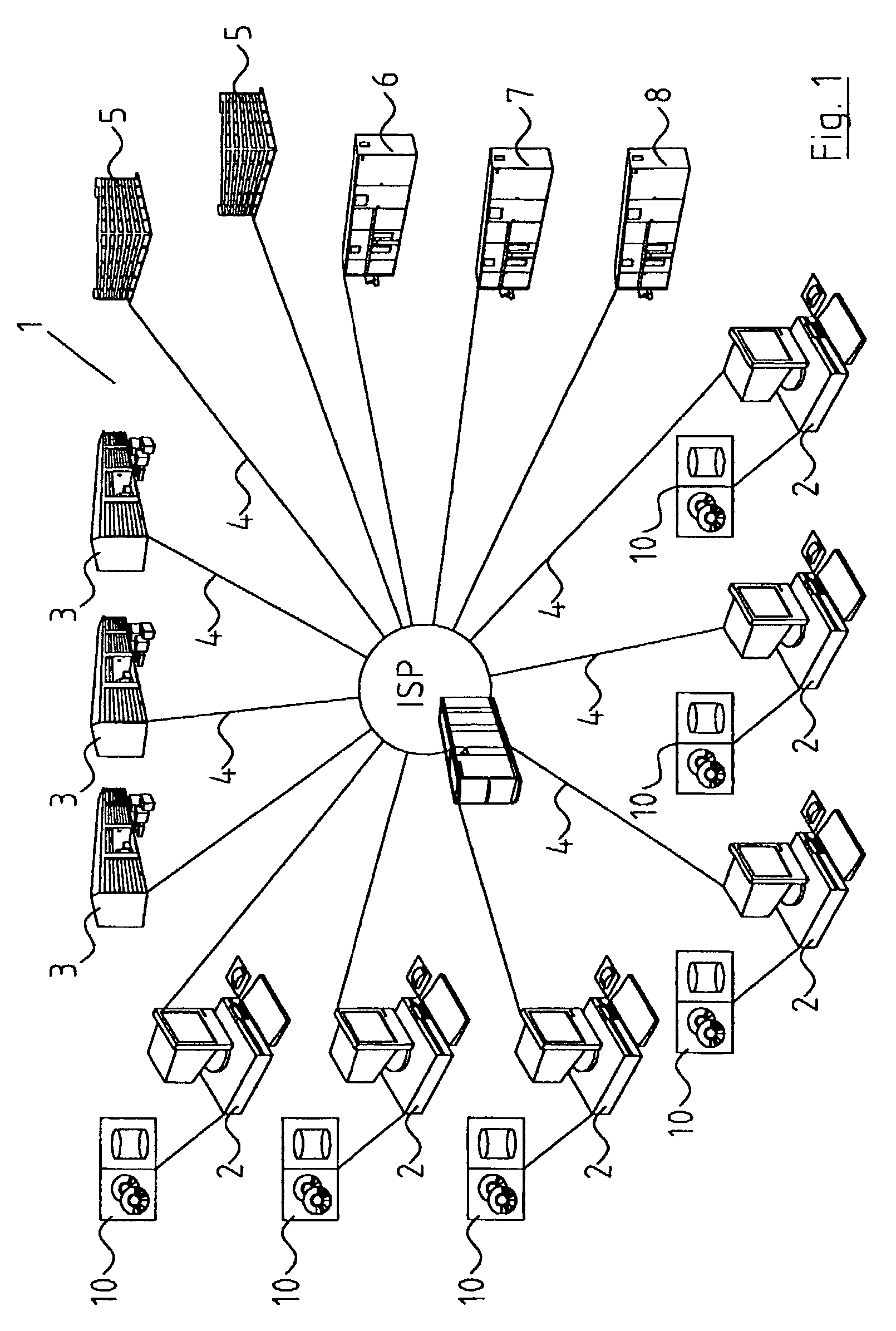

System for secure transactions

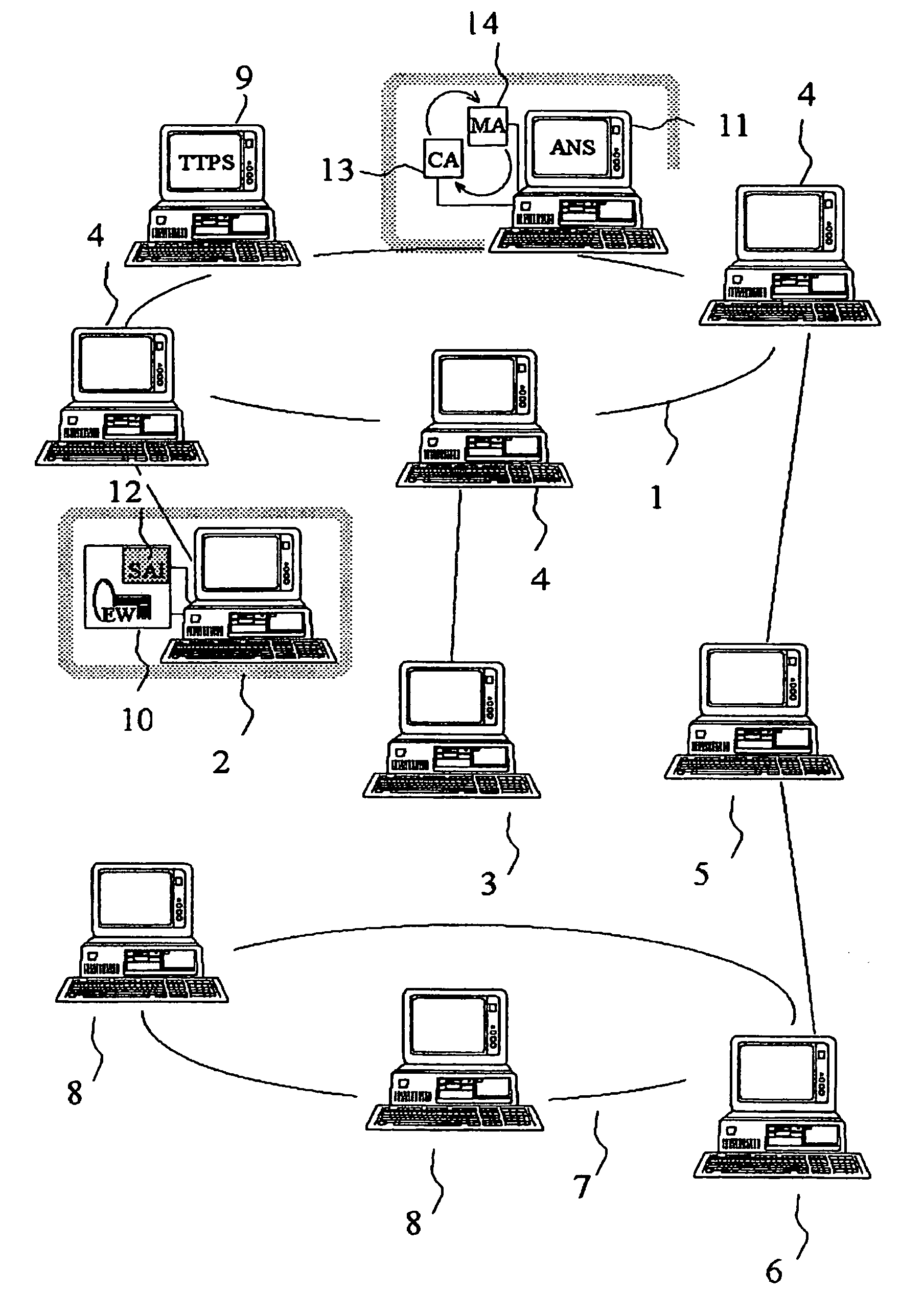

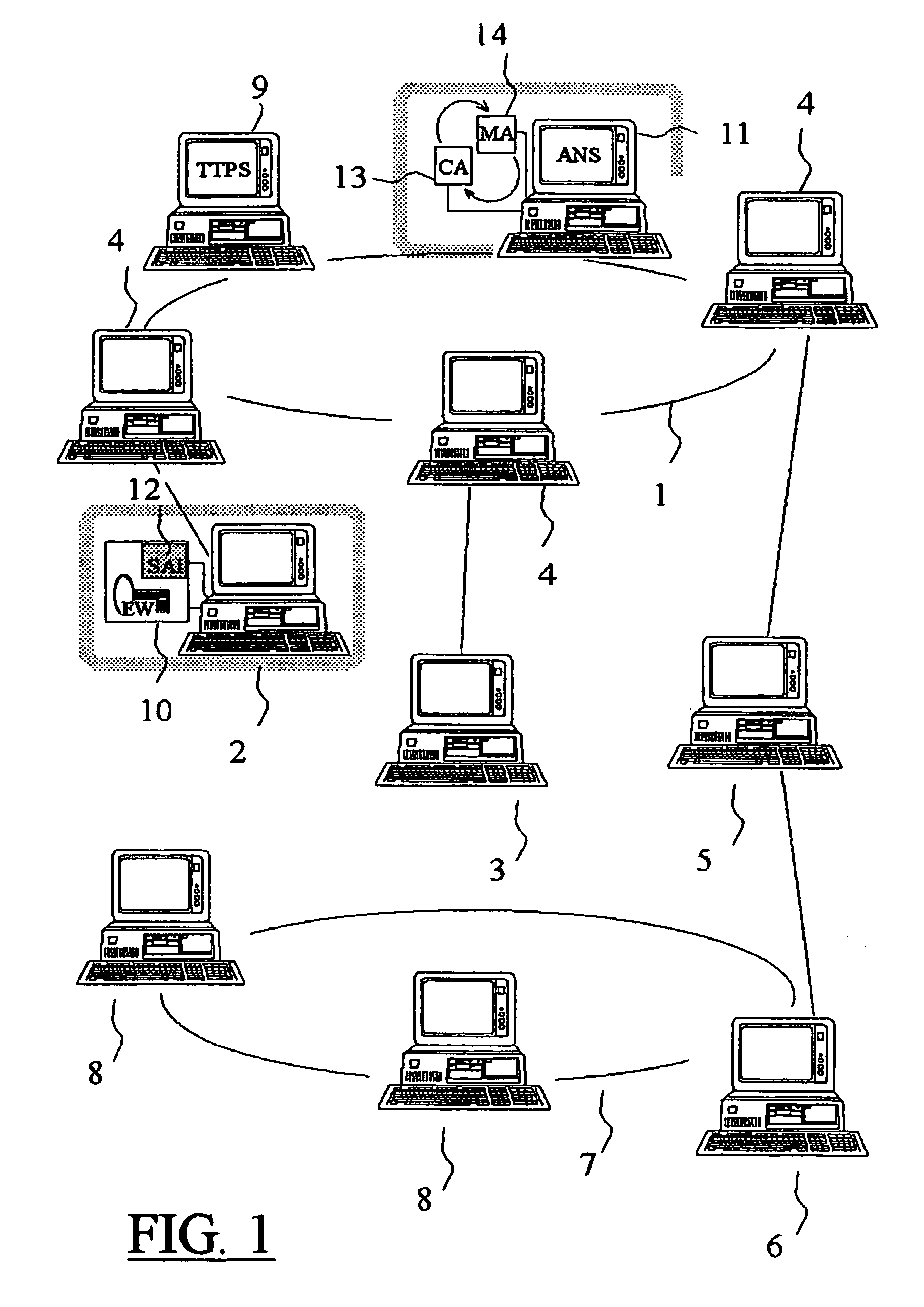

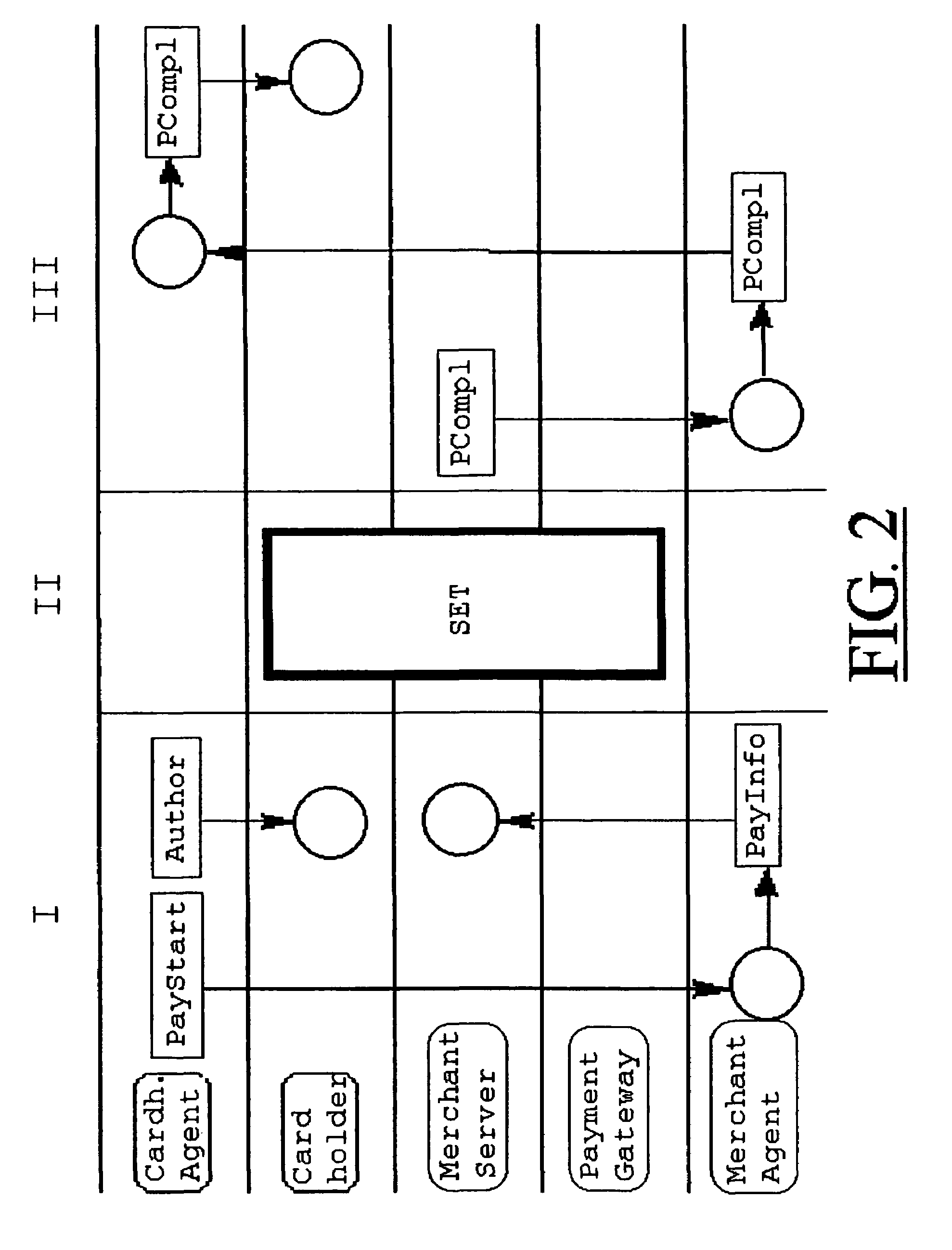

A multimedia network (1) with connected customer stations (2), merchant servers (3), and a payment server (5). Secure electronic transactions are performed using a secure electronic transactions protocol (SET), including exchange of digital certificates, managed by a Trusted Third Party Server (9). The customer stations comprise transactions management means (10), fit for performing said SET protocol and for managing said certificates for the customer station. A remote customer agent (13) represents the customer station in the negotiation and payment process. The customer station (2) comprises an agent interface (12), fit for transmission of codes, parameters and certificates between the customer agent (13) and the transactions management means (10). A remote merchant agent (14) represents the merchant station (3) in the negotiation and payment process with the customer agent (13) or the customer station (3), to have paid for the selected products in a secure way, under control of SET protocol.

Owner:NOKIA CORP

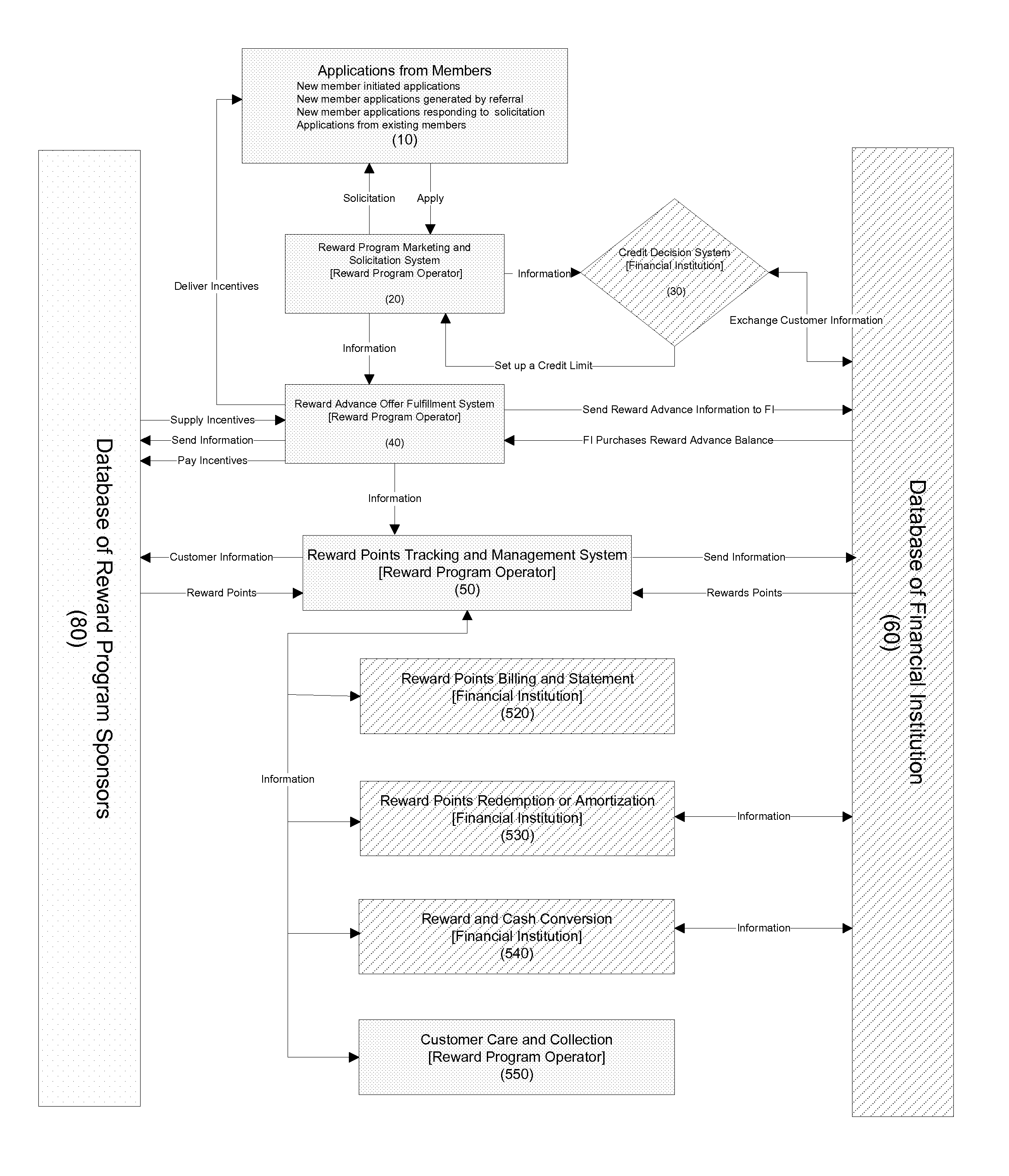

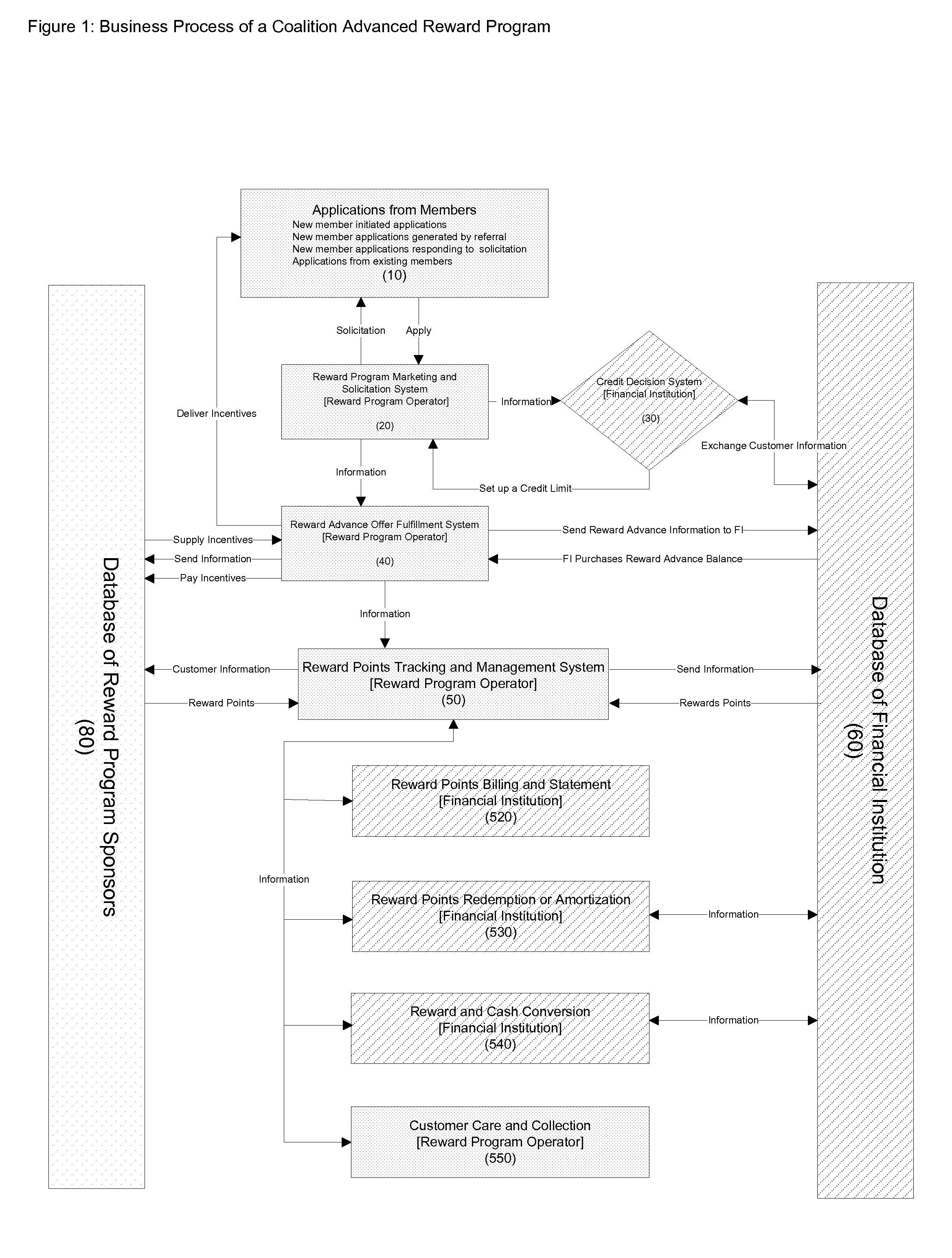

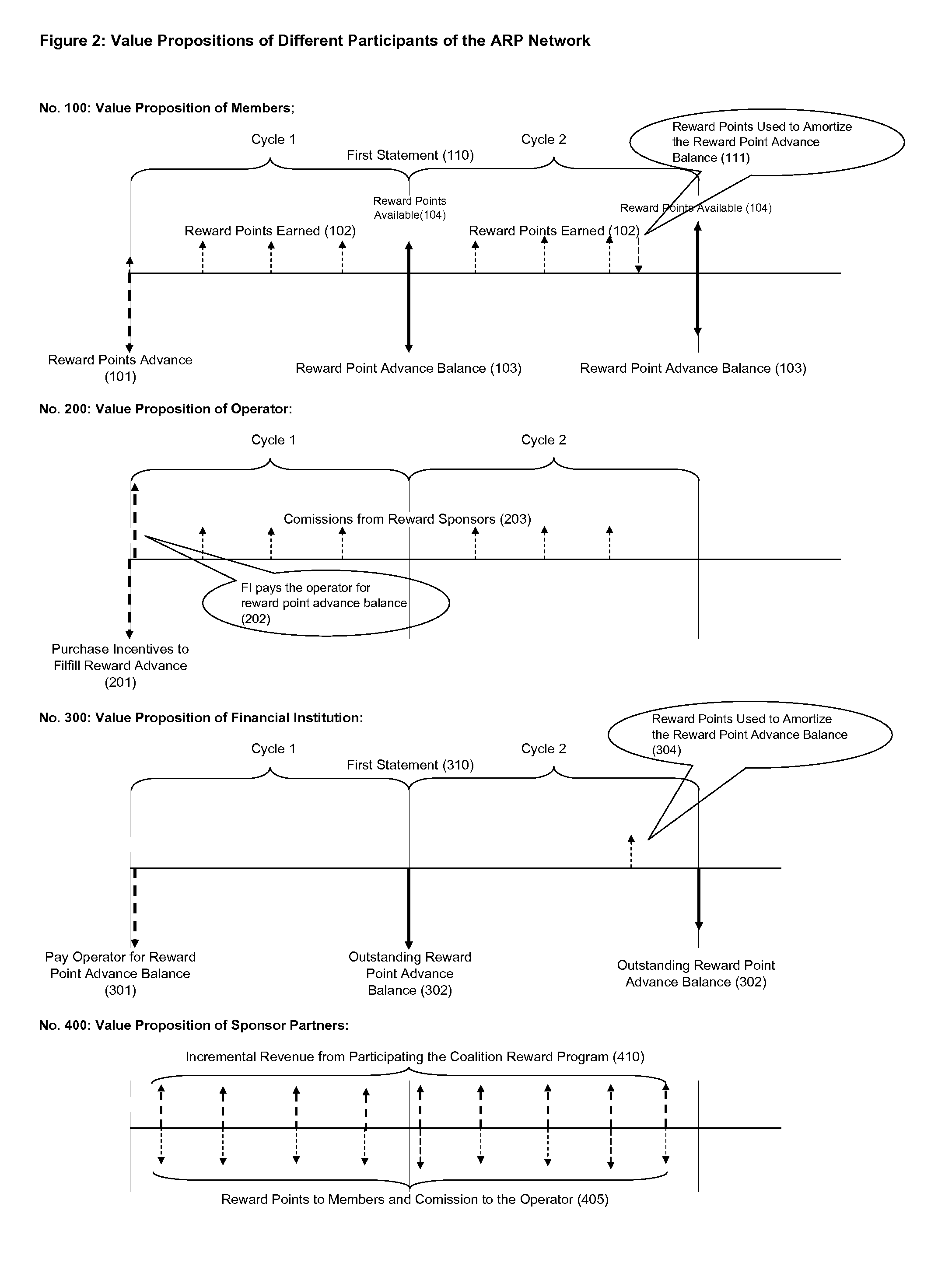

Method and System for Advanced Reward Program

InactiveUS20070239523A1Faster can accrueIncrease valueDiscounts/incentivesFinanceCredit cardMerchant services

The present invention provides business process, method and computer based techniques for reward program operators to offer reward point advance to their members. Both multi-partner and proprietary reward applications can utilize the present invention to attract new customers, retain existing customers and increase sales volume. A preferred embodiment of the present invention involves a credit account established by a financial institution, especially a credit card issuer. A coalition reward program can take full advantage of the present invention by leveraging value propositions of financial institutions, retailers, merchants, service providers, manufacturers, etc. A credit card issuer owning a reward platform can be at the best position to implement the present invention with minimal incremental investments.

Owner:YI JUN

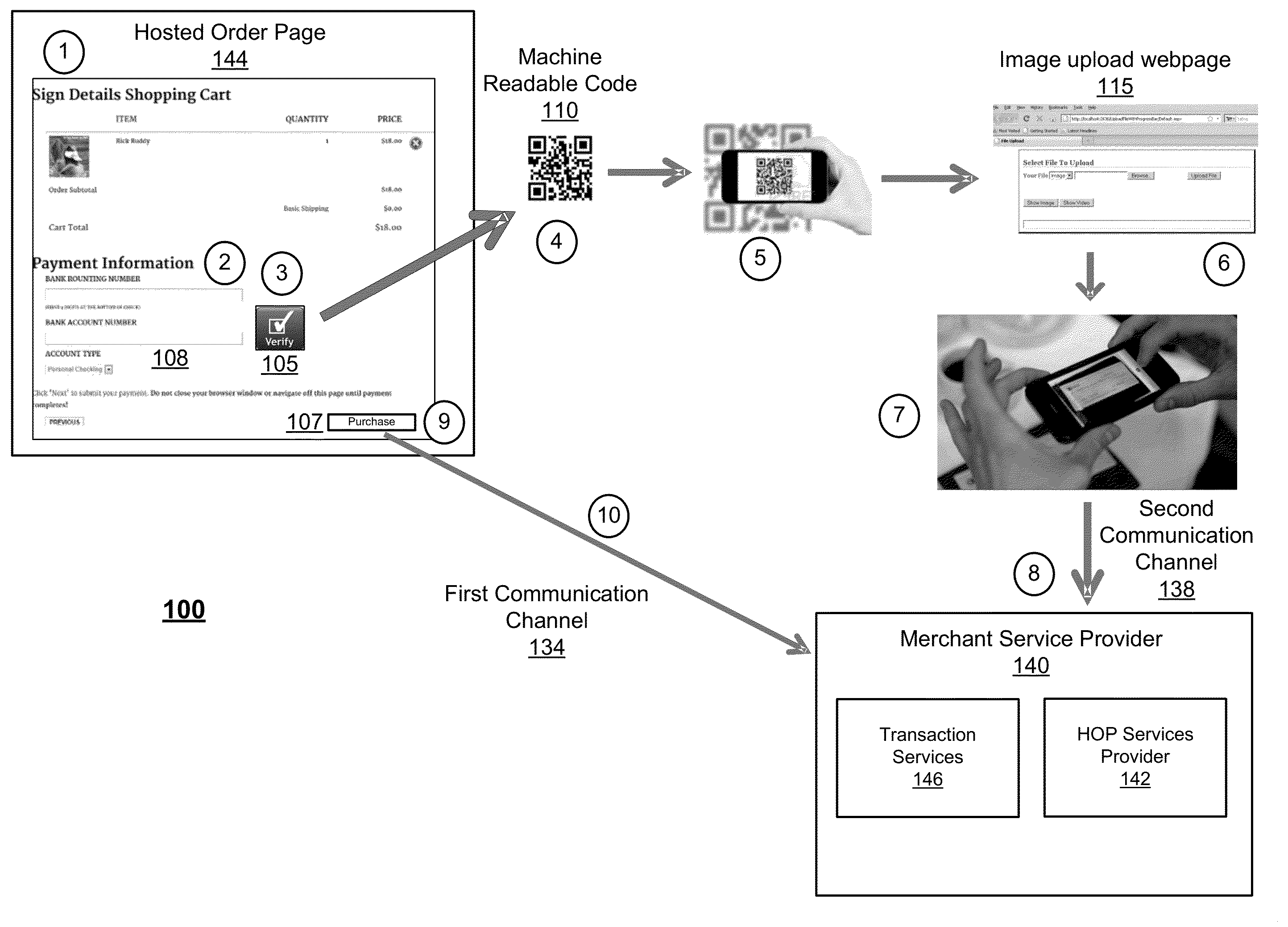

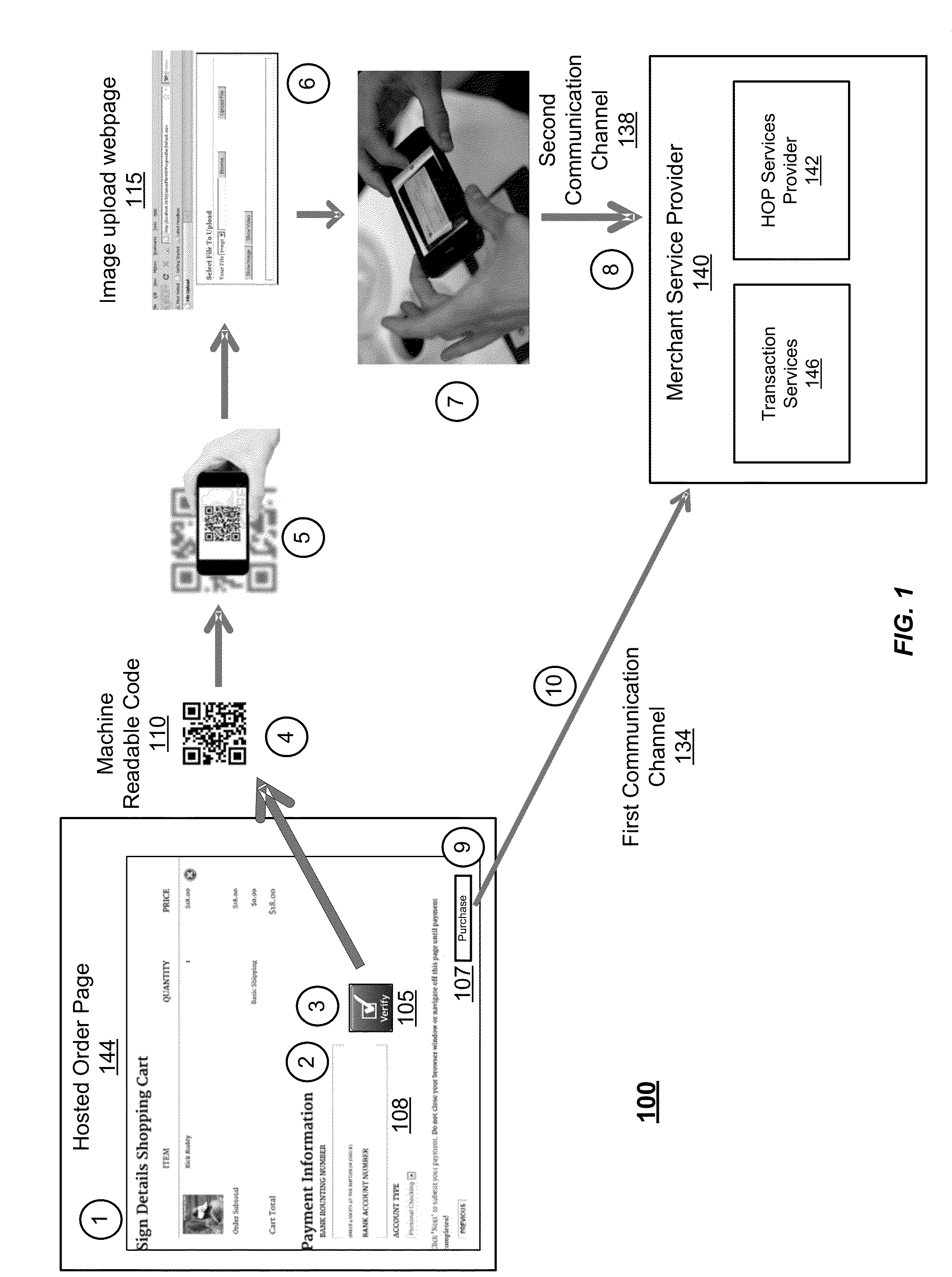

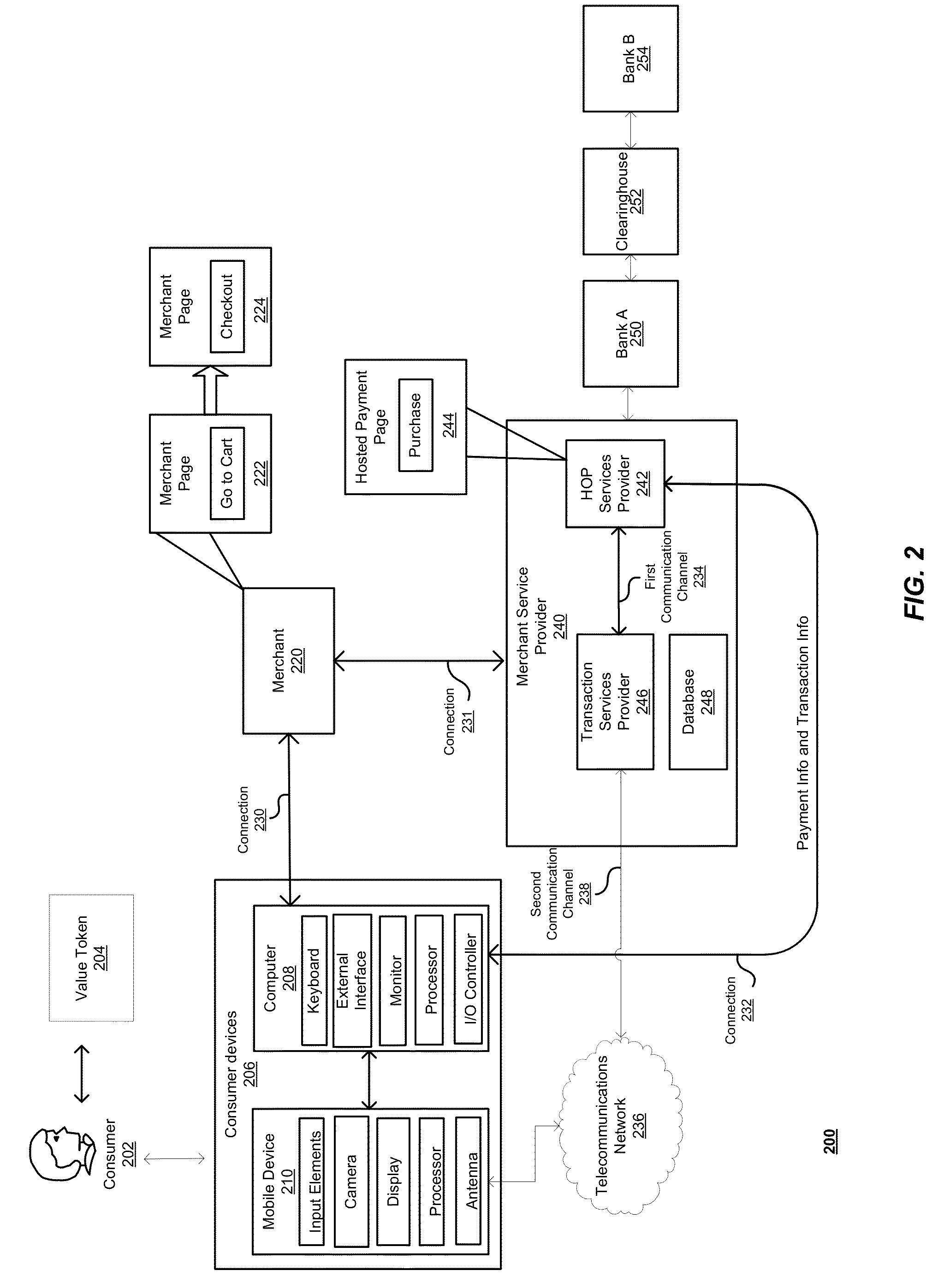

Bank account number validation

A method for validating payment information for an online transaction is provided. A payment server can receive two representations of the same payment information. The payment information can be validated if it is determined that the two representations match. If there is no match, or the payment information is otherwise invalid, the payment information can be repaired based on a trusted representation of the payment information, such as stored payment information or an image of an associated value token. Payment information can be received via one or more communication channels, and can be provided by one or more consumer devices. A merchant service provider can validate payment information and handle transaction processing on behalf of a merchant.

Owner:VISA INT SERVICE ASSOC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com