Patents

Literature

75 results about "Financial transfer" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

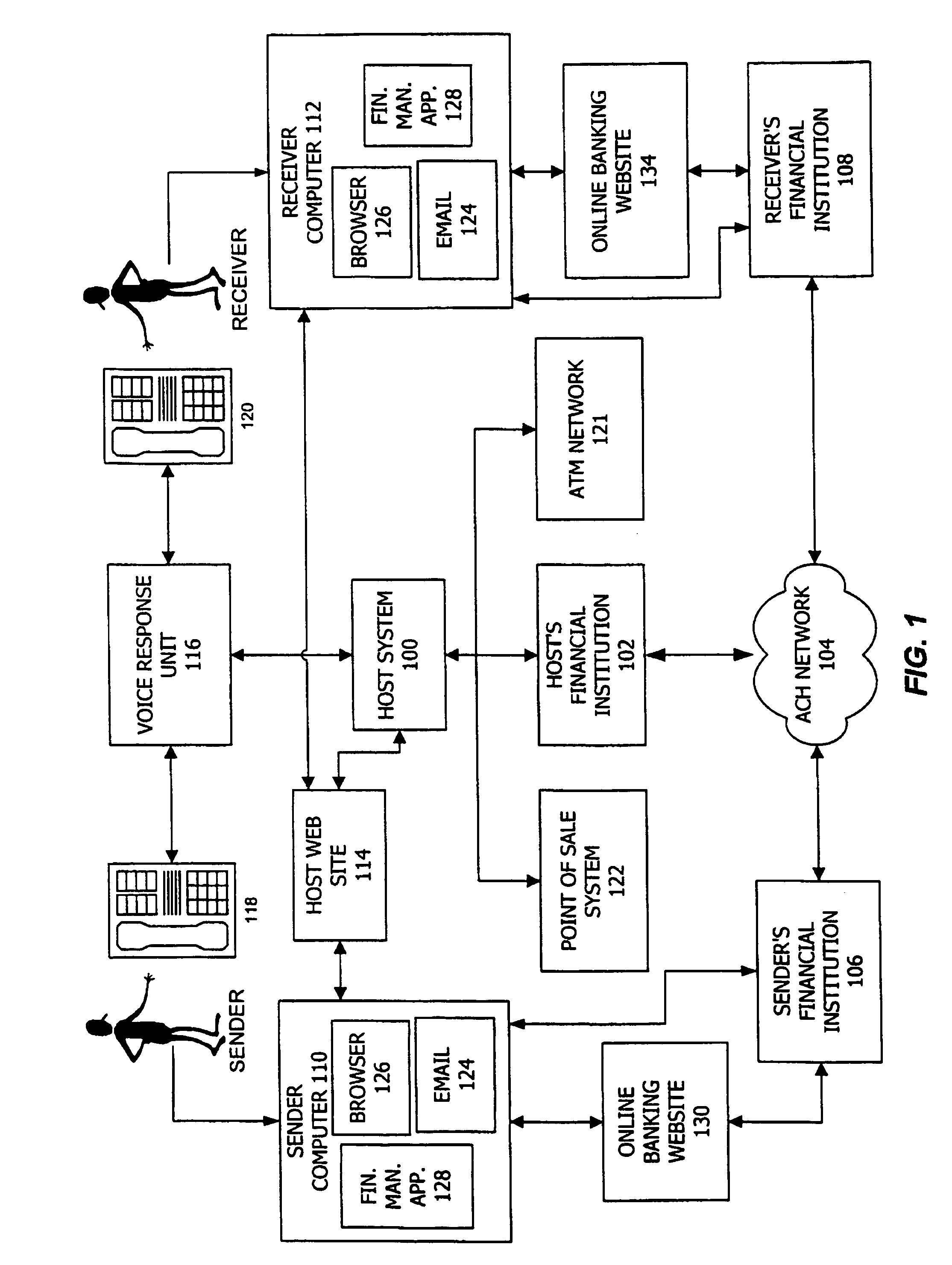

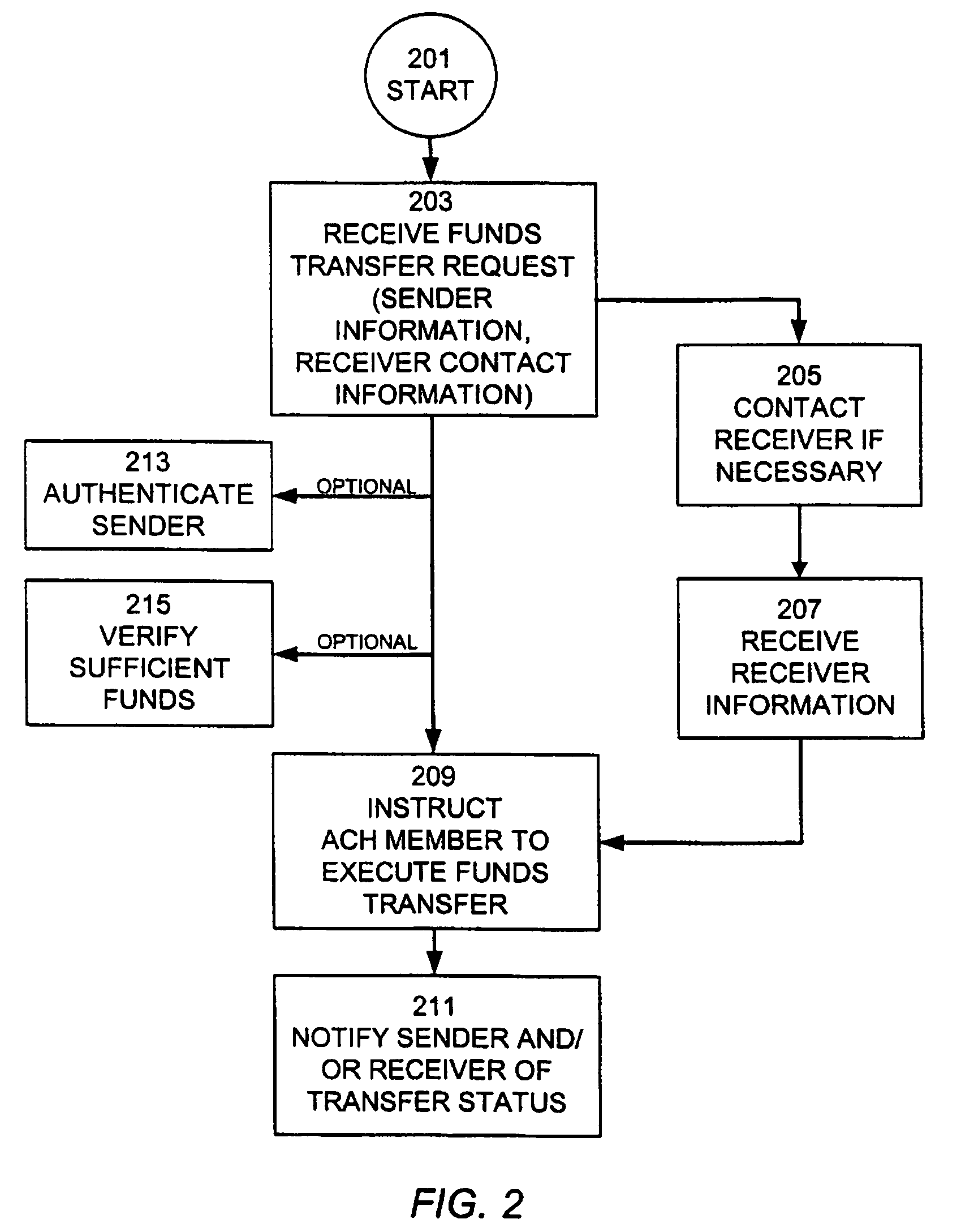

Consumer-directed financial transfers using automated clearinghouse networks

InactiveUS7395241B1Allocation is accurateEliminate contactComplete banking machinesFinanceThe InternetCheque

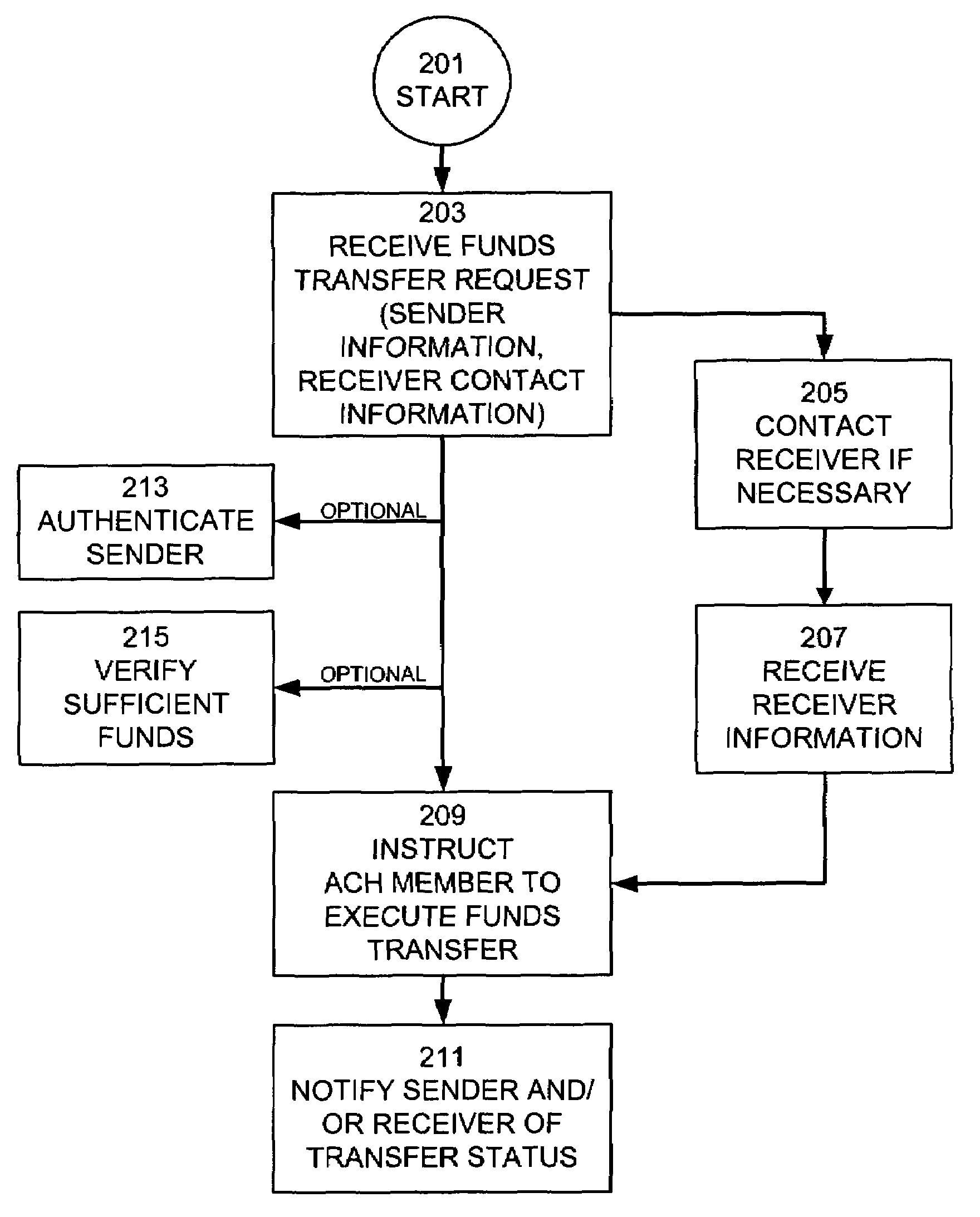

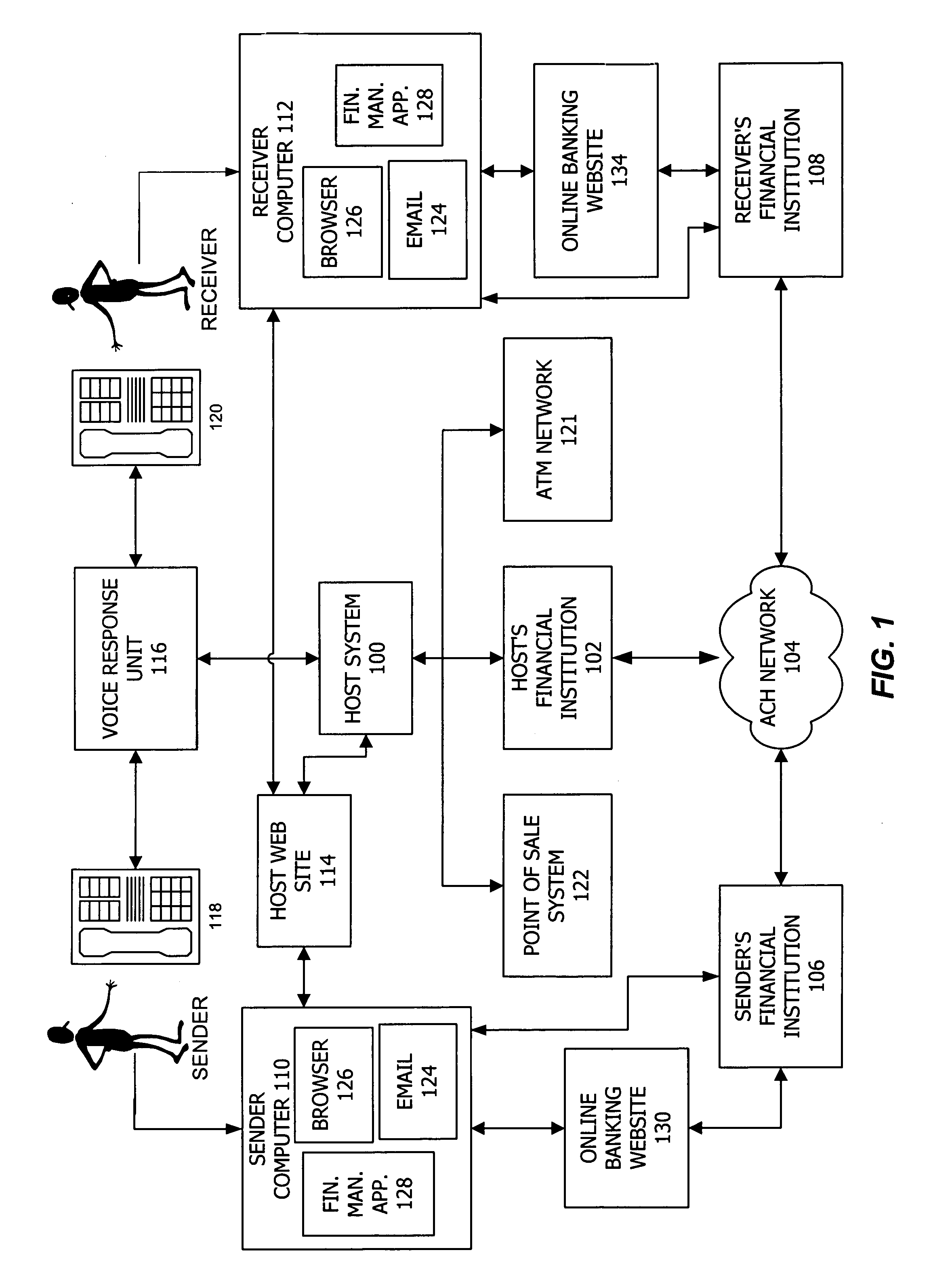

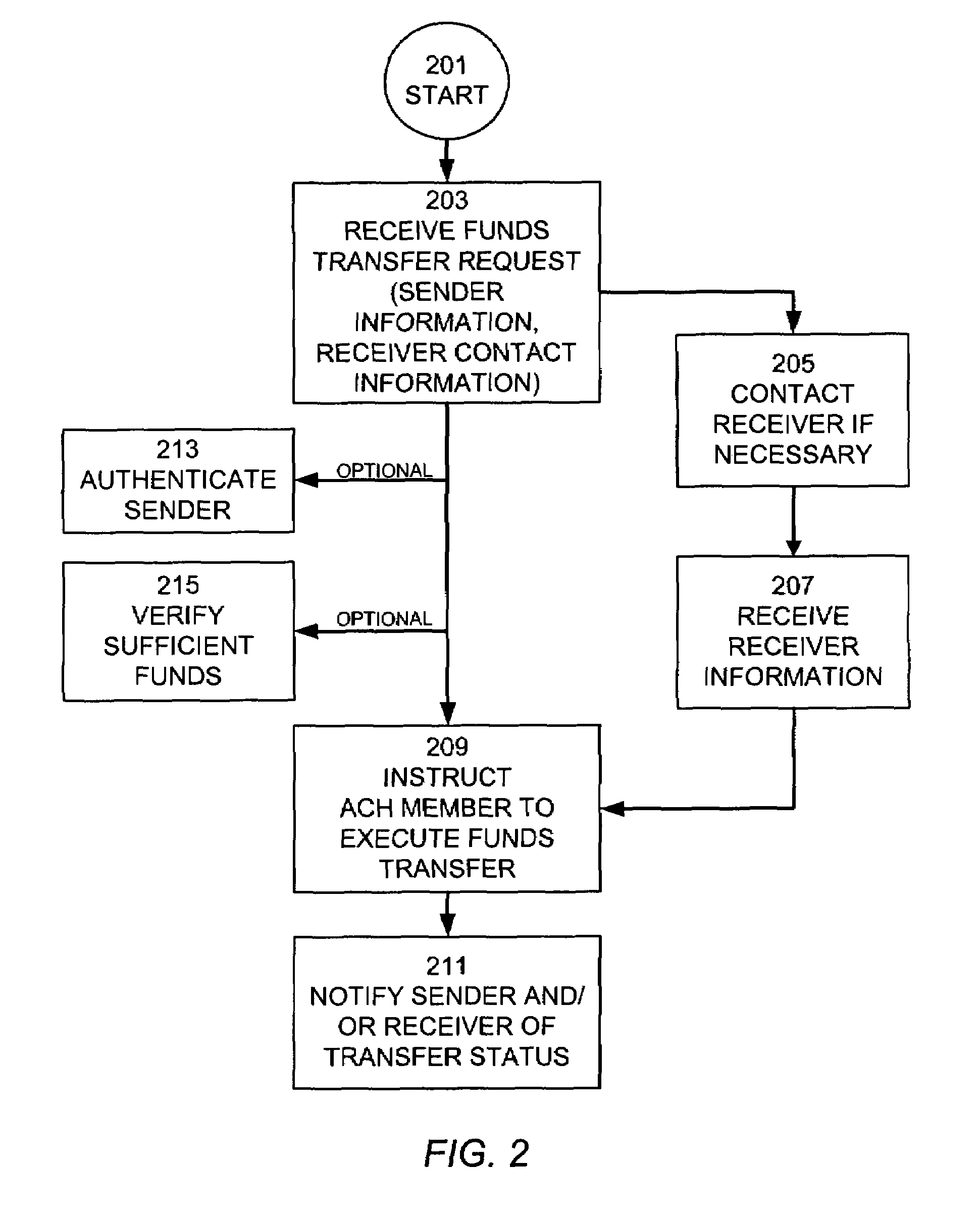

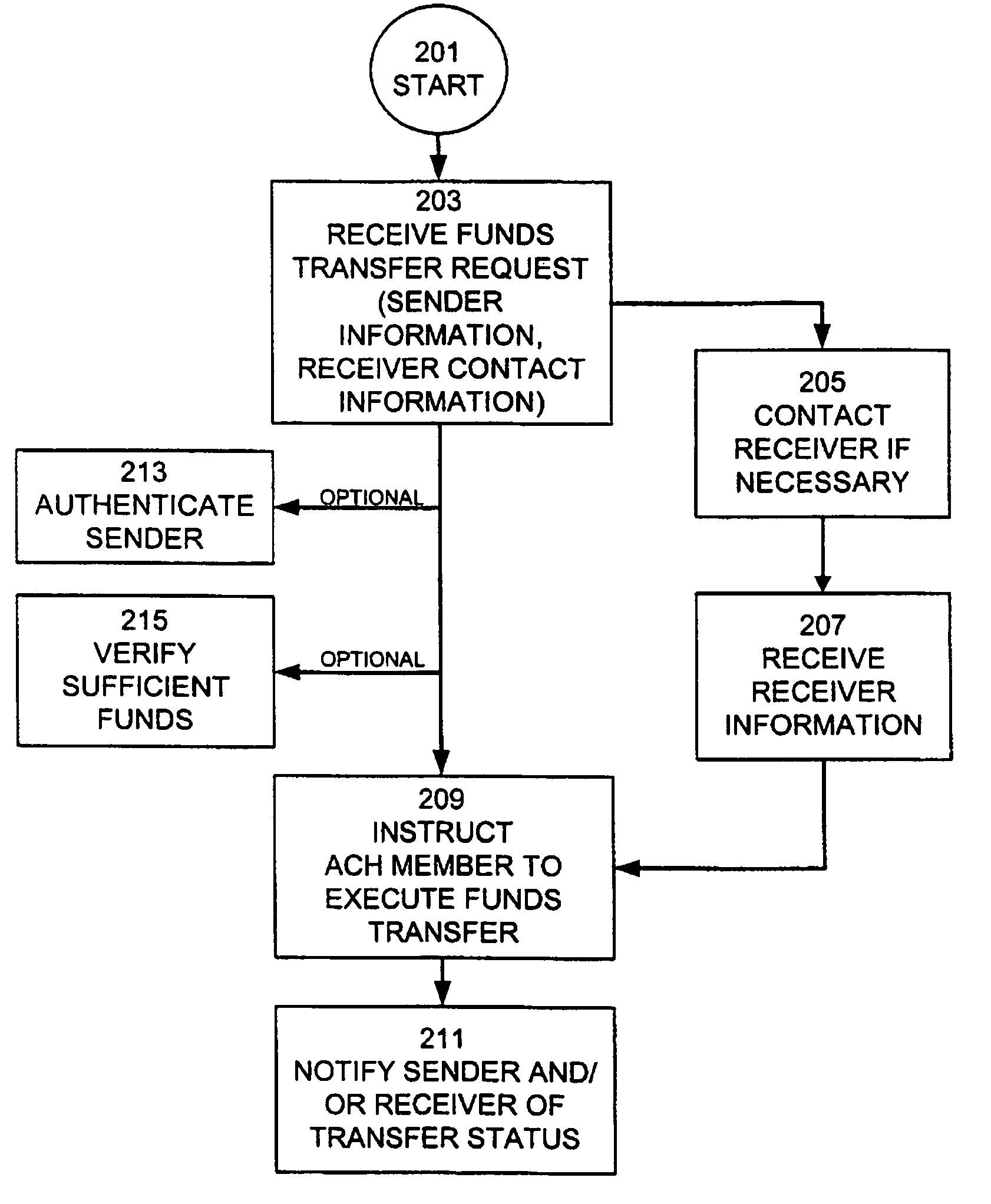

Consumer directed transfers of funds over the Internet are provided by a combination of systems and networks, including the Internet, email, and the Automated Clearinghouse system (ACH). A host system provided by a funds transfer service manages requests of senders to transfer funds and further manages responses of receivers to claim funds. The host system allows the sender to initiate the funds transfer by specifying the amount of the transfer and information for contacting the receiver, without the need to specify the account of the receiver for receiving the funds. Instead, the host system contacts the receiver and informs the receiver of the available funds; the receiver can then provide the necessary target account information for completing the funds transfer. The ACH is used to effect the transfer of funds, with the host system providing instructions for ACH entries to its financial institution using account information separately received from the sender and receiver. The credit risk associated with originating ACH entries is reduced by use of the Point of Sale system to verify sufficient funds in the sender's account by comparing the closing balance of the day the funds transfer is requested with the transfer amount. Sender fraud is reduced by comparing a sender provided balance (or check number / amounts) with an account balance acquired through automated means such as the POS system or ATM network.

Owner:INTUIT INC

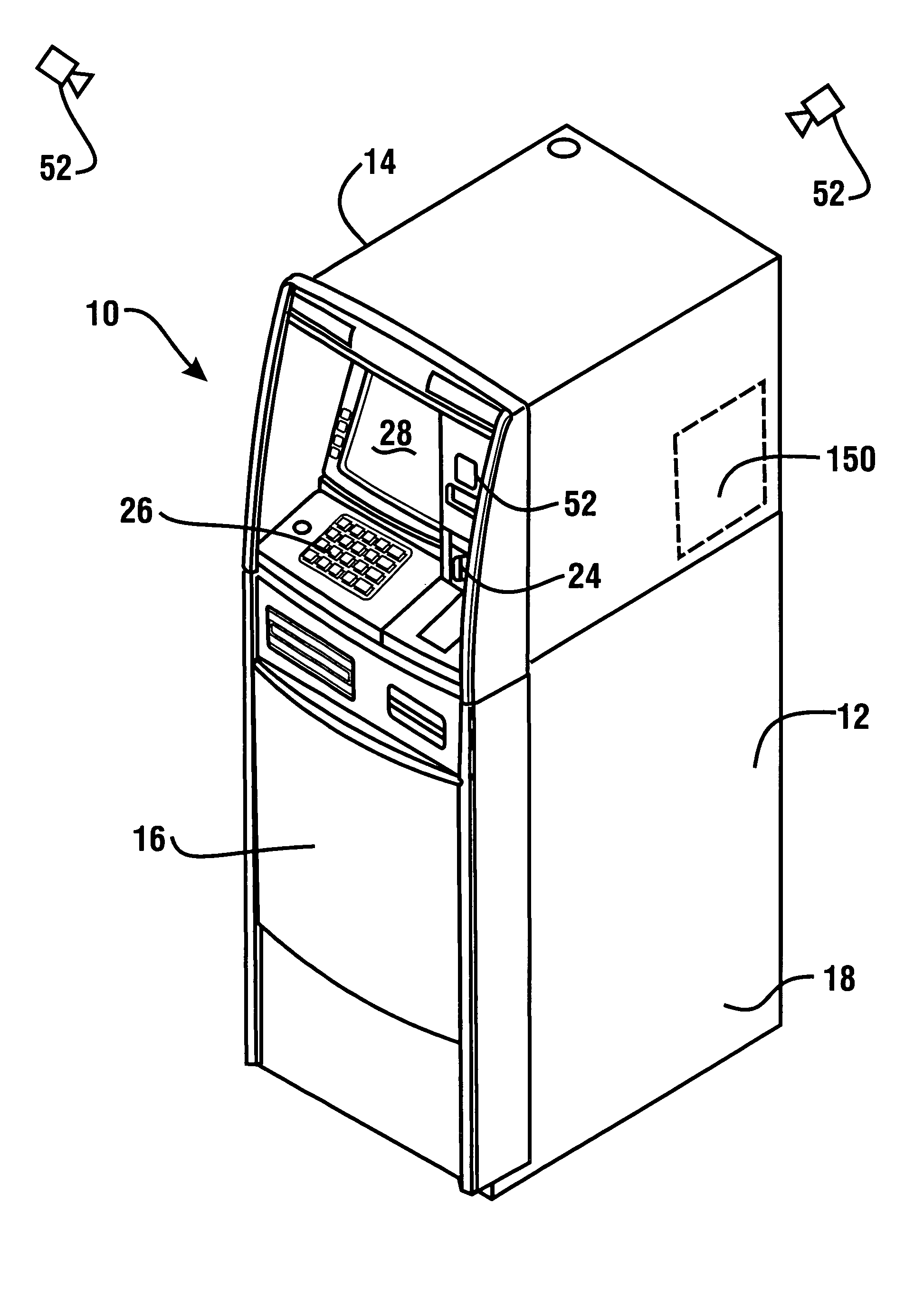

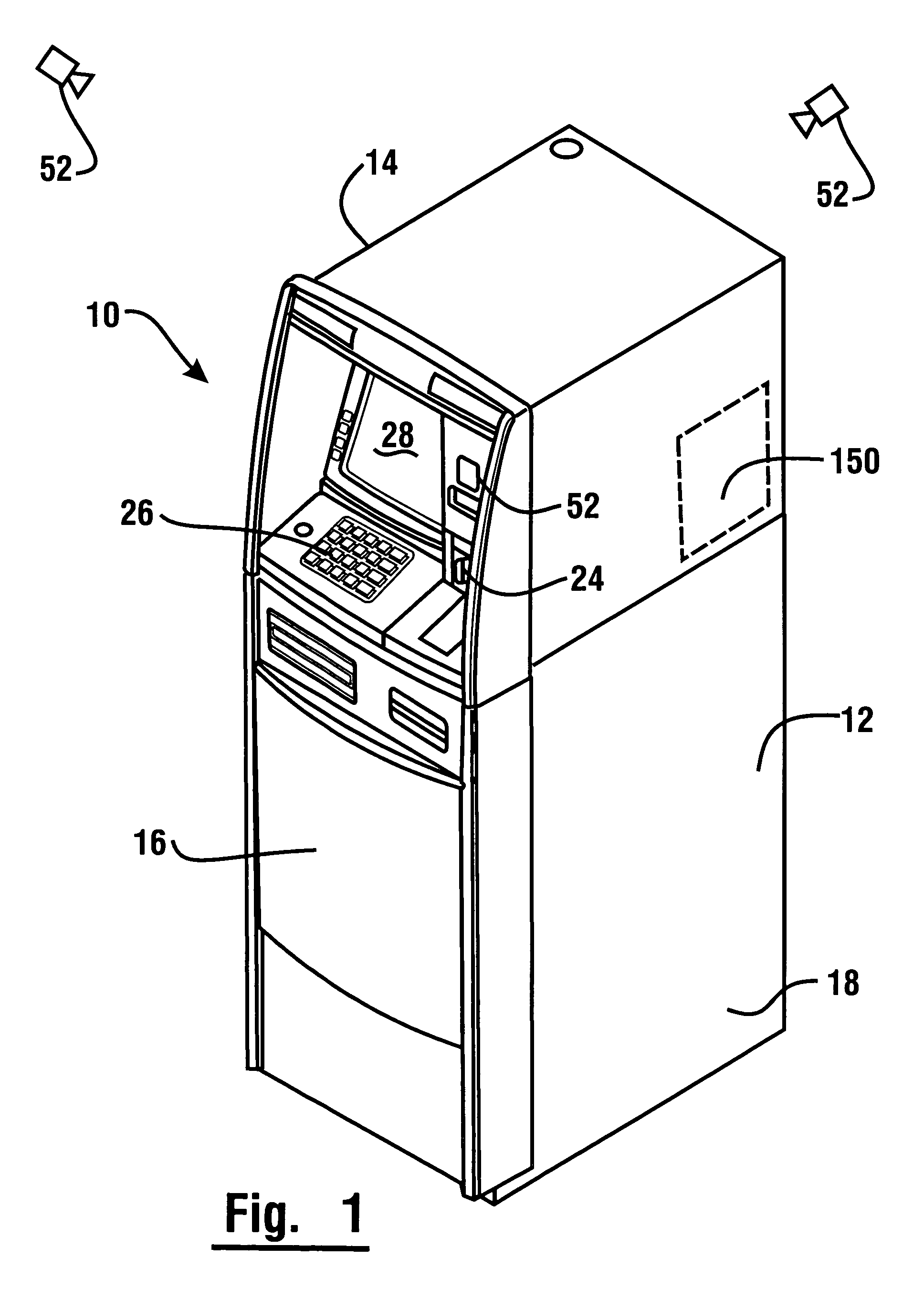

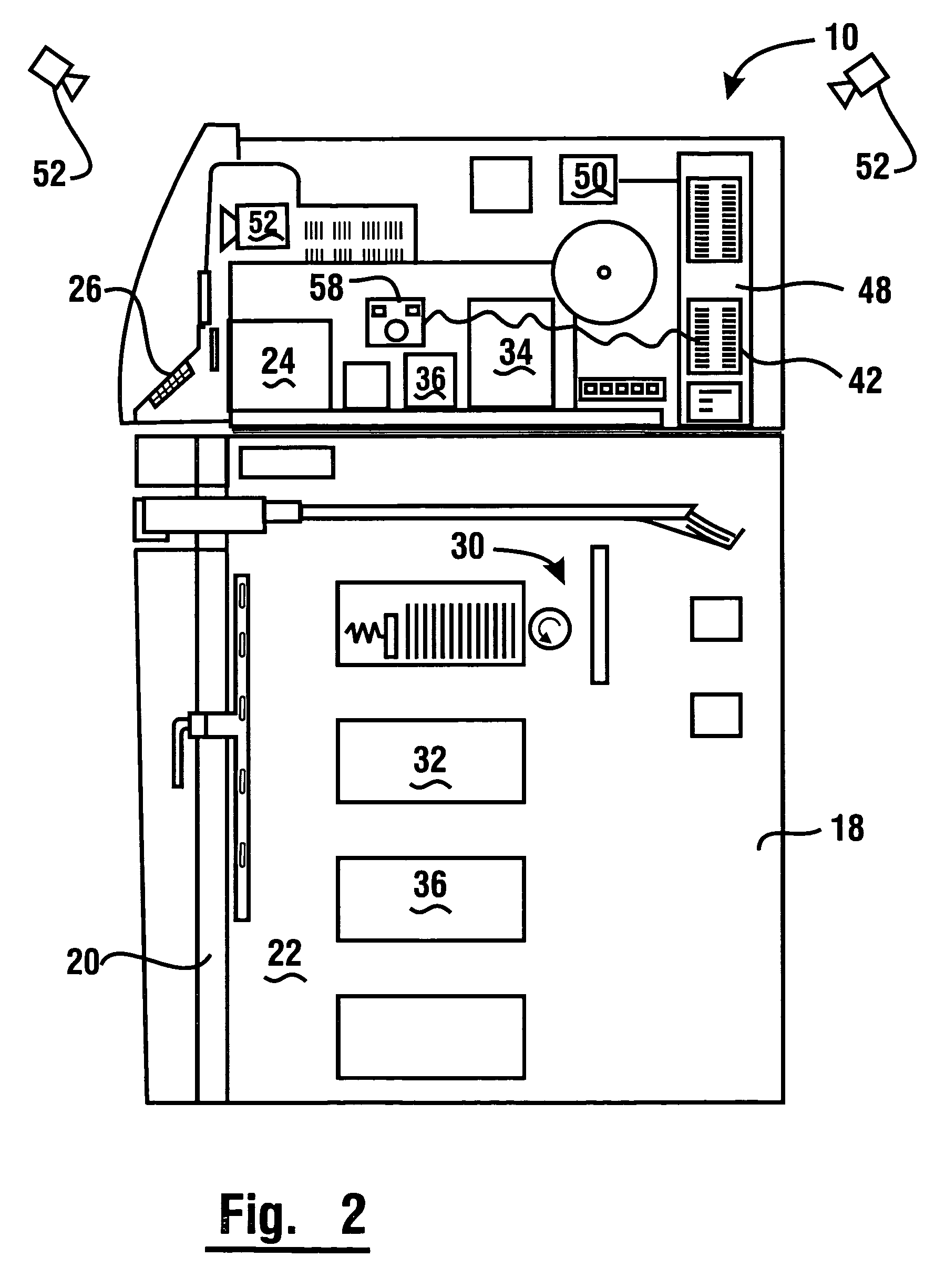

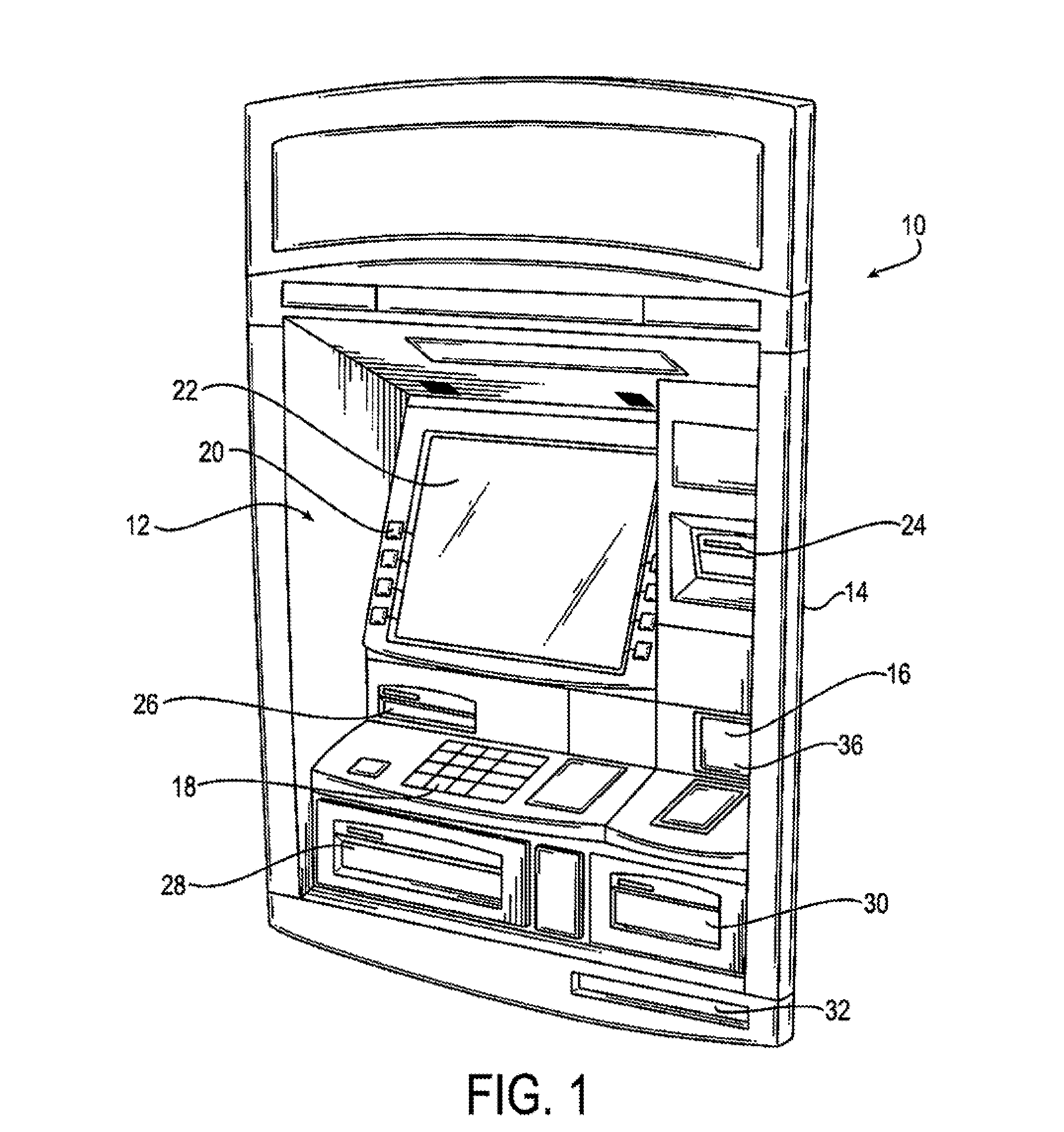

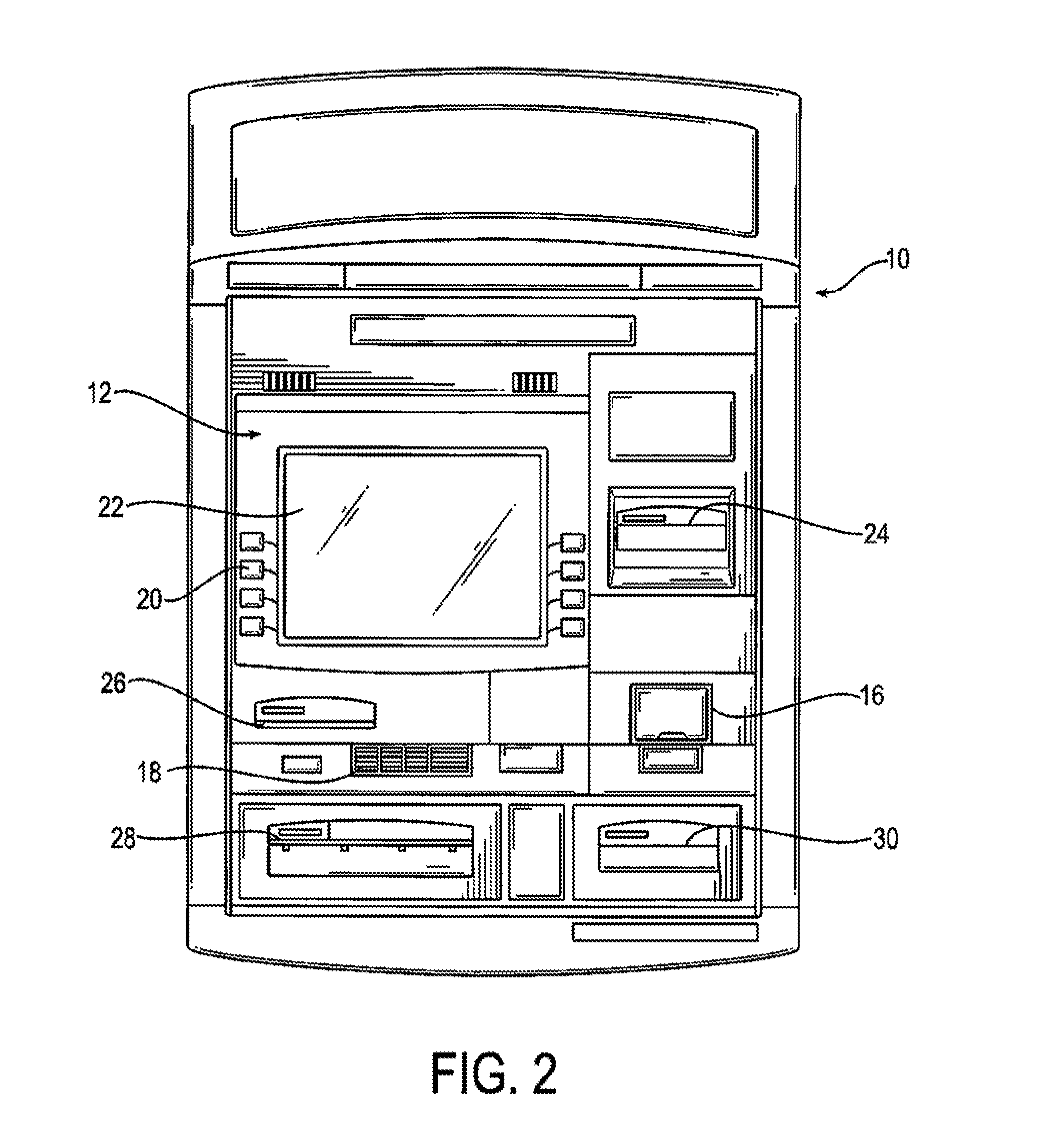

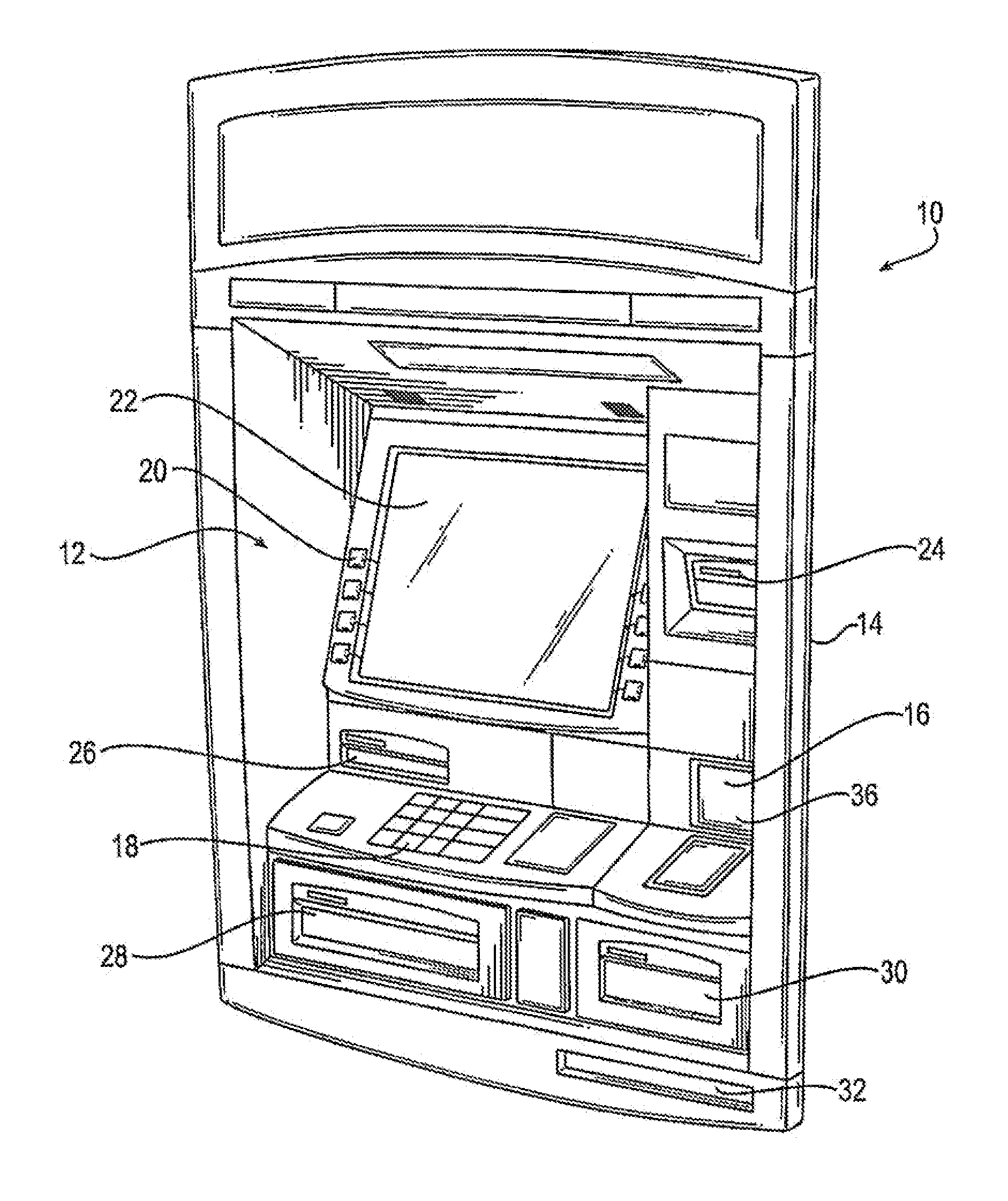

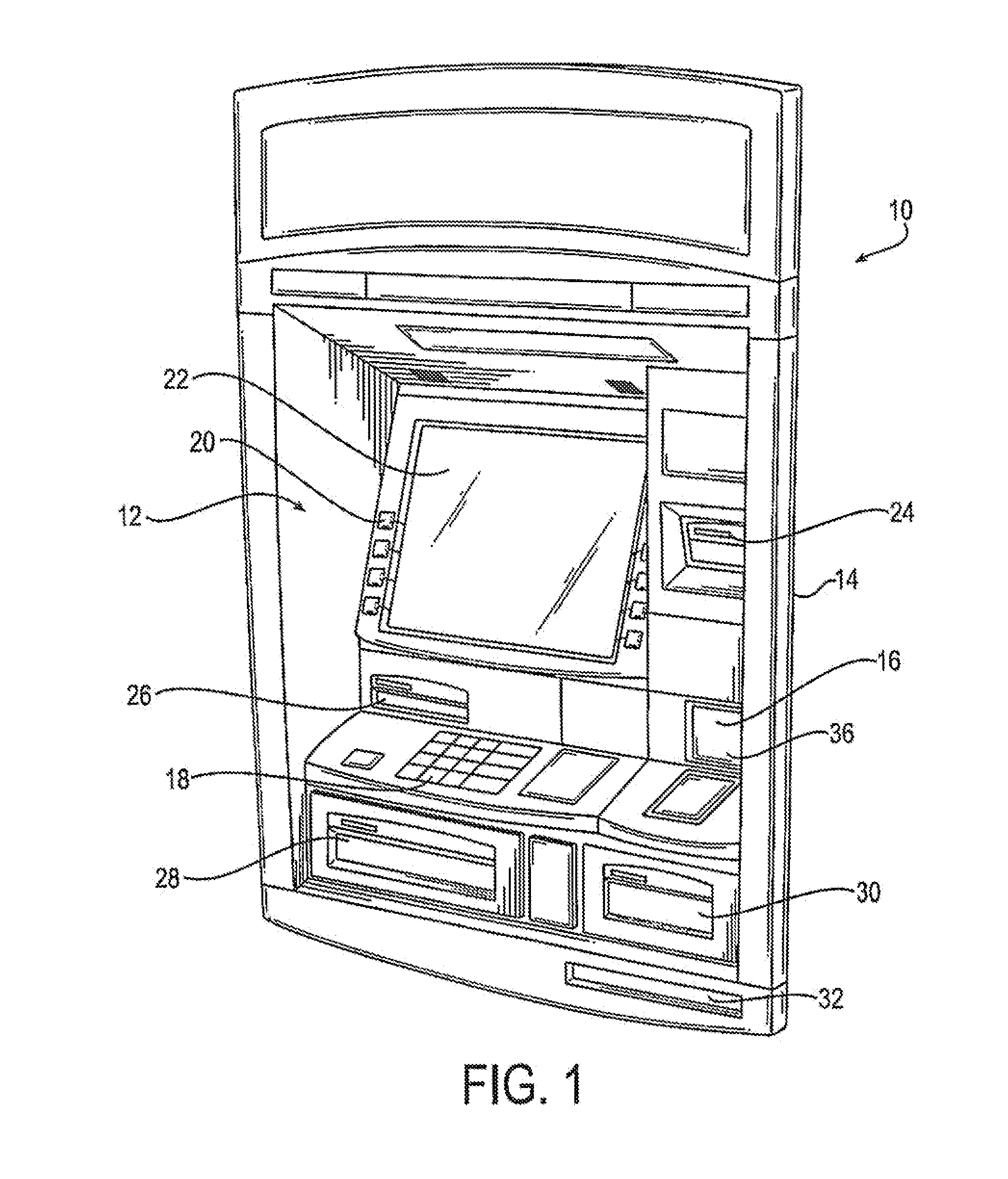

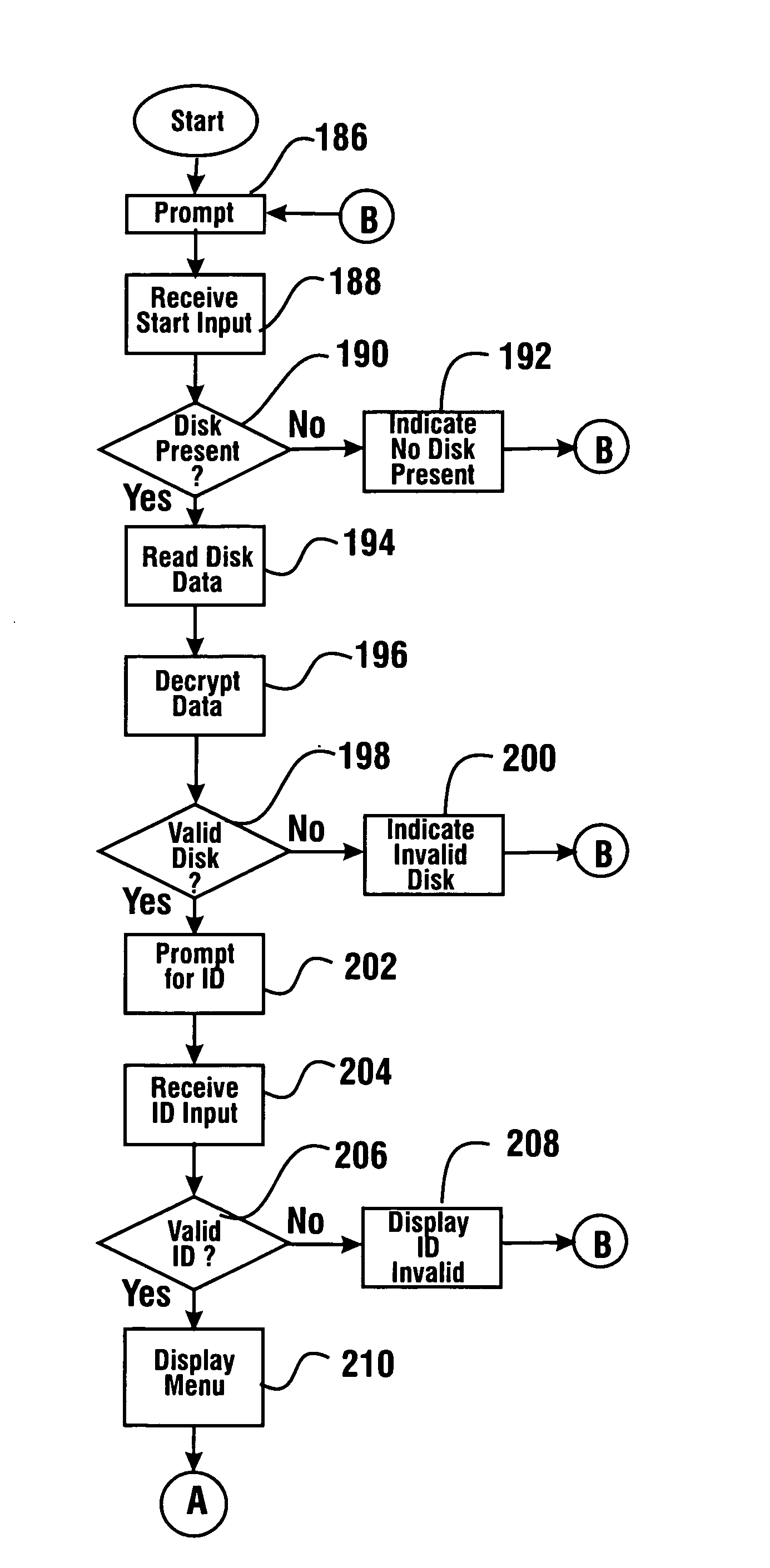

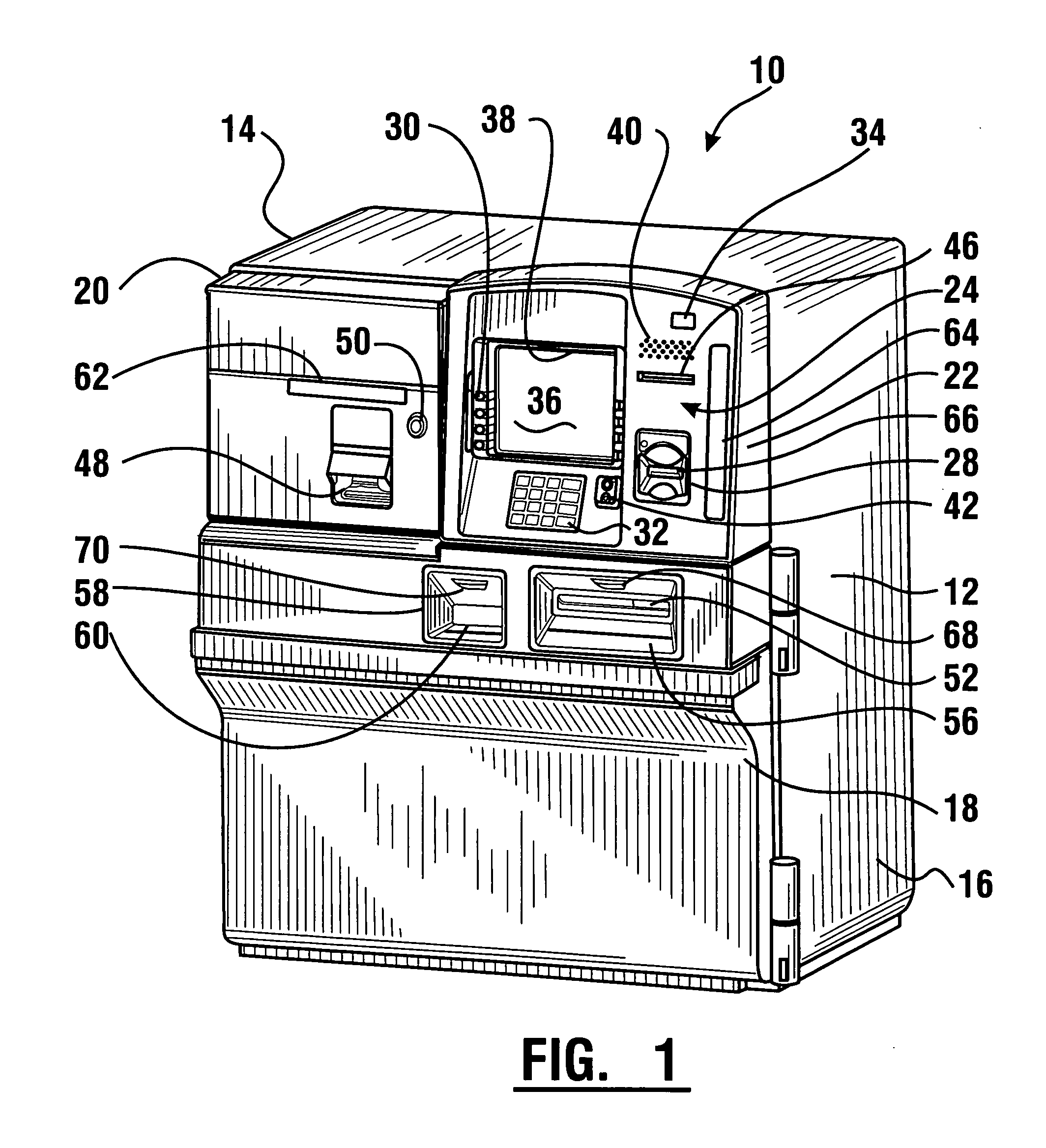

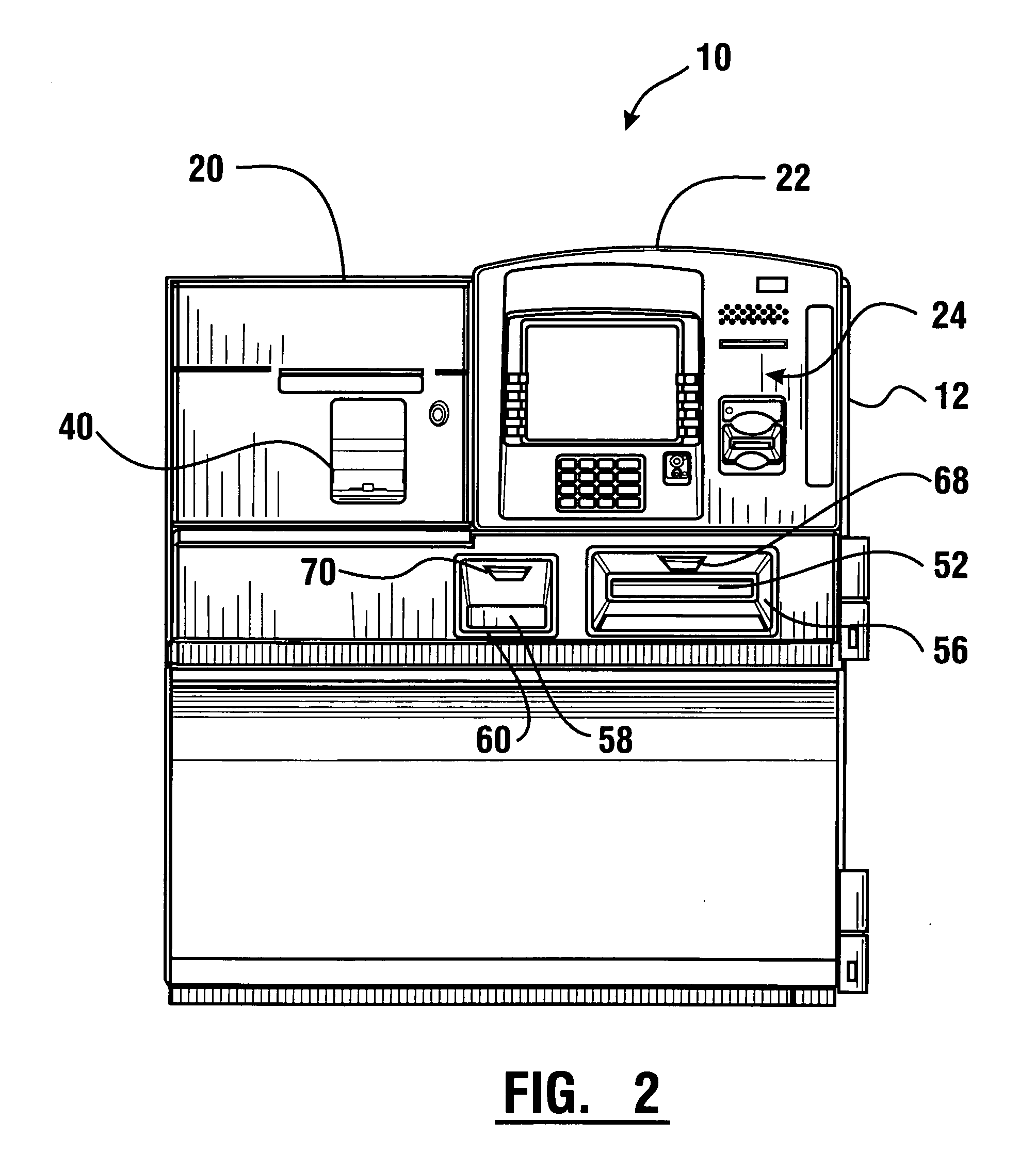

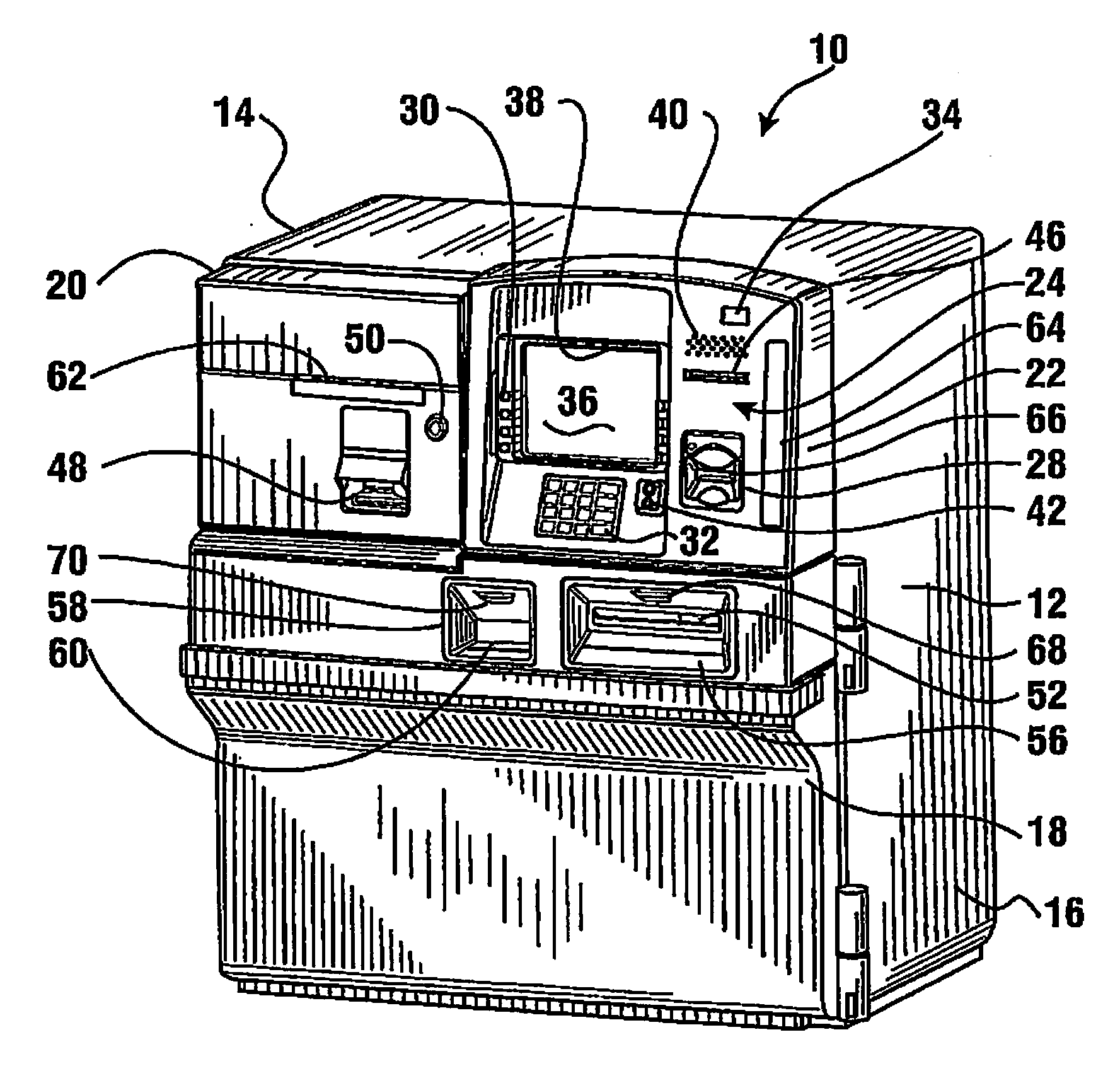

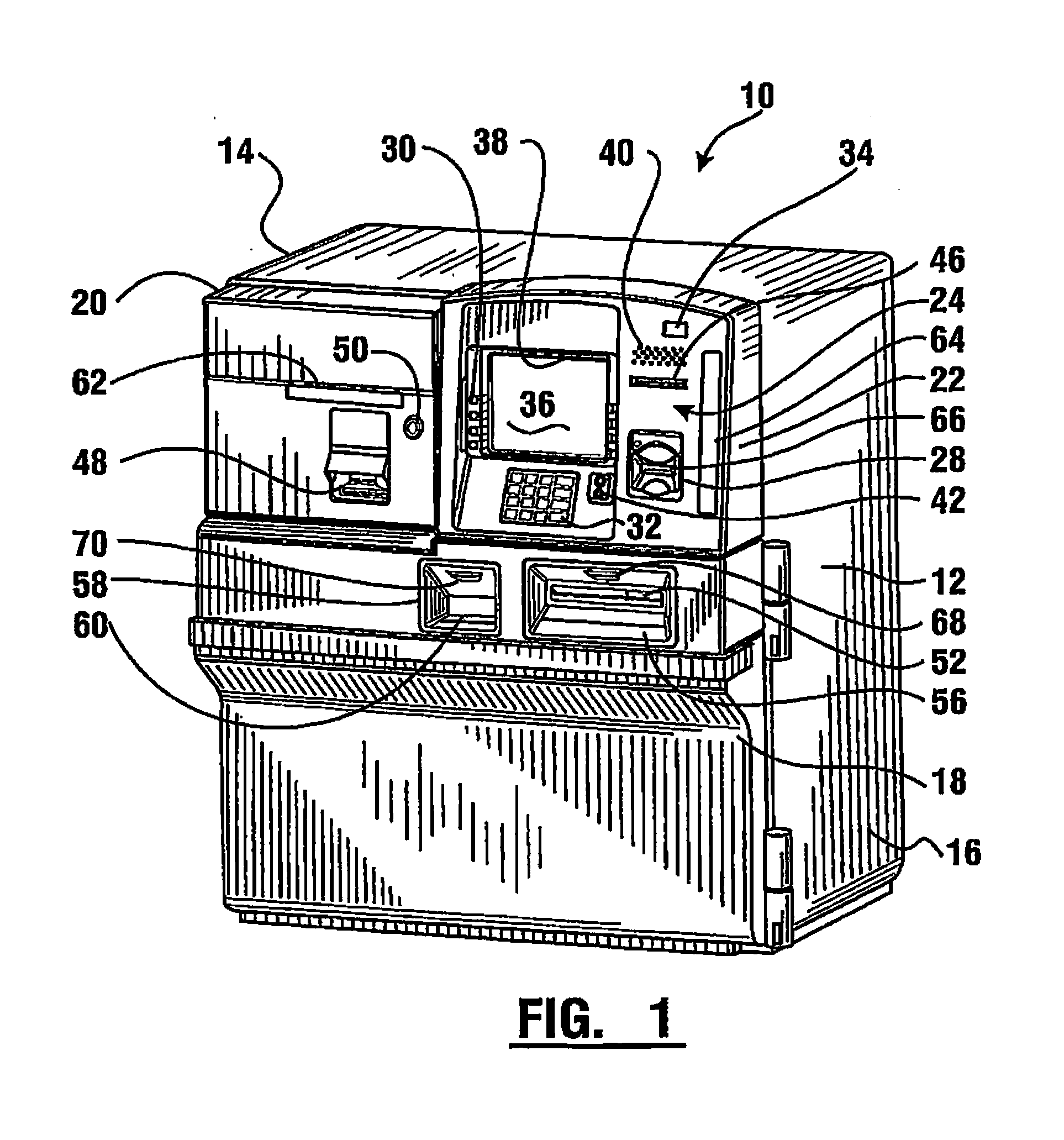

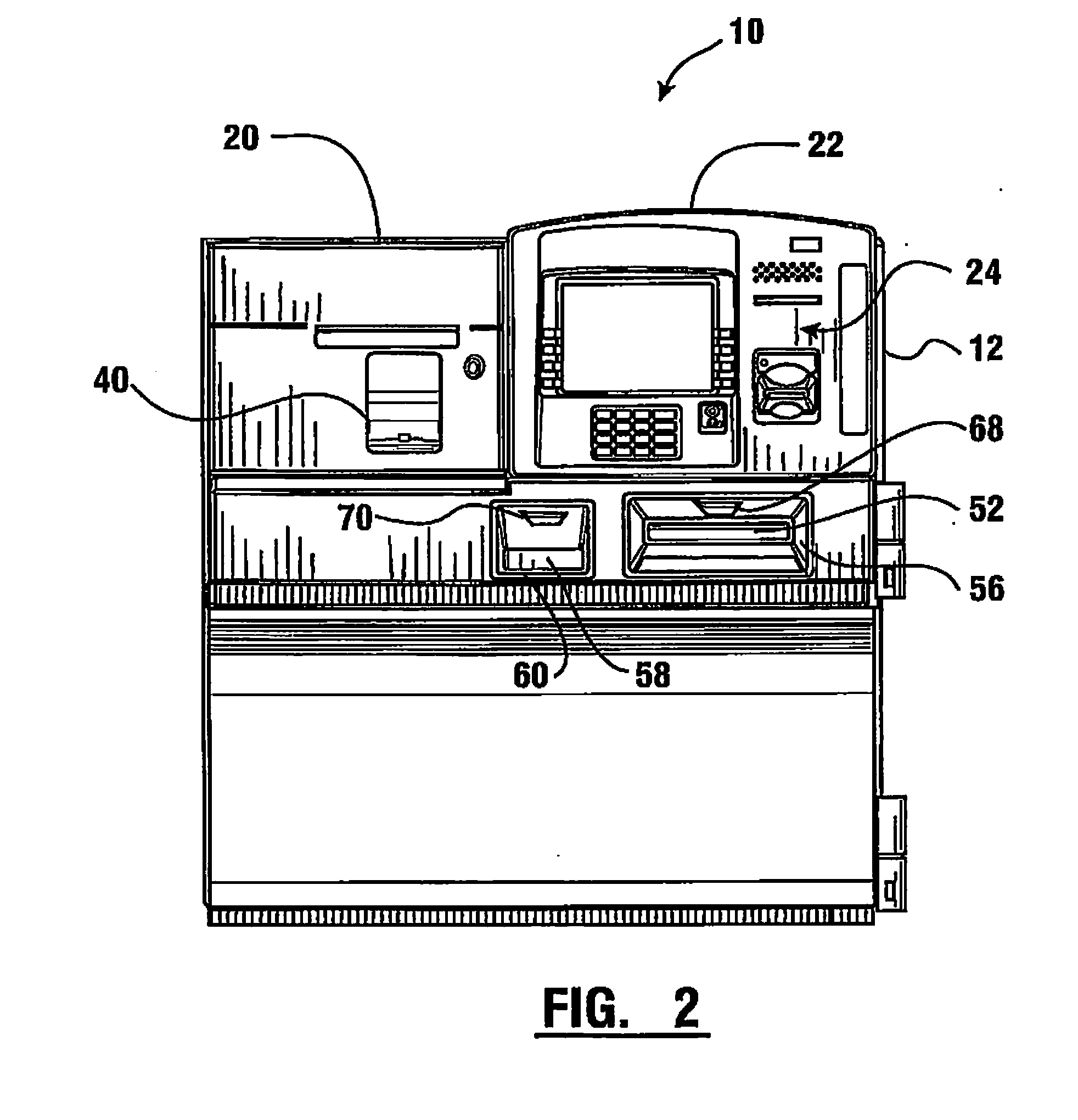

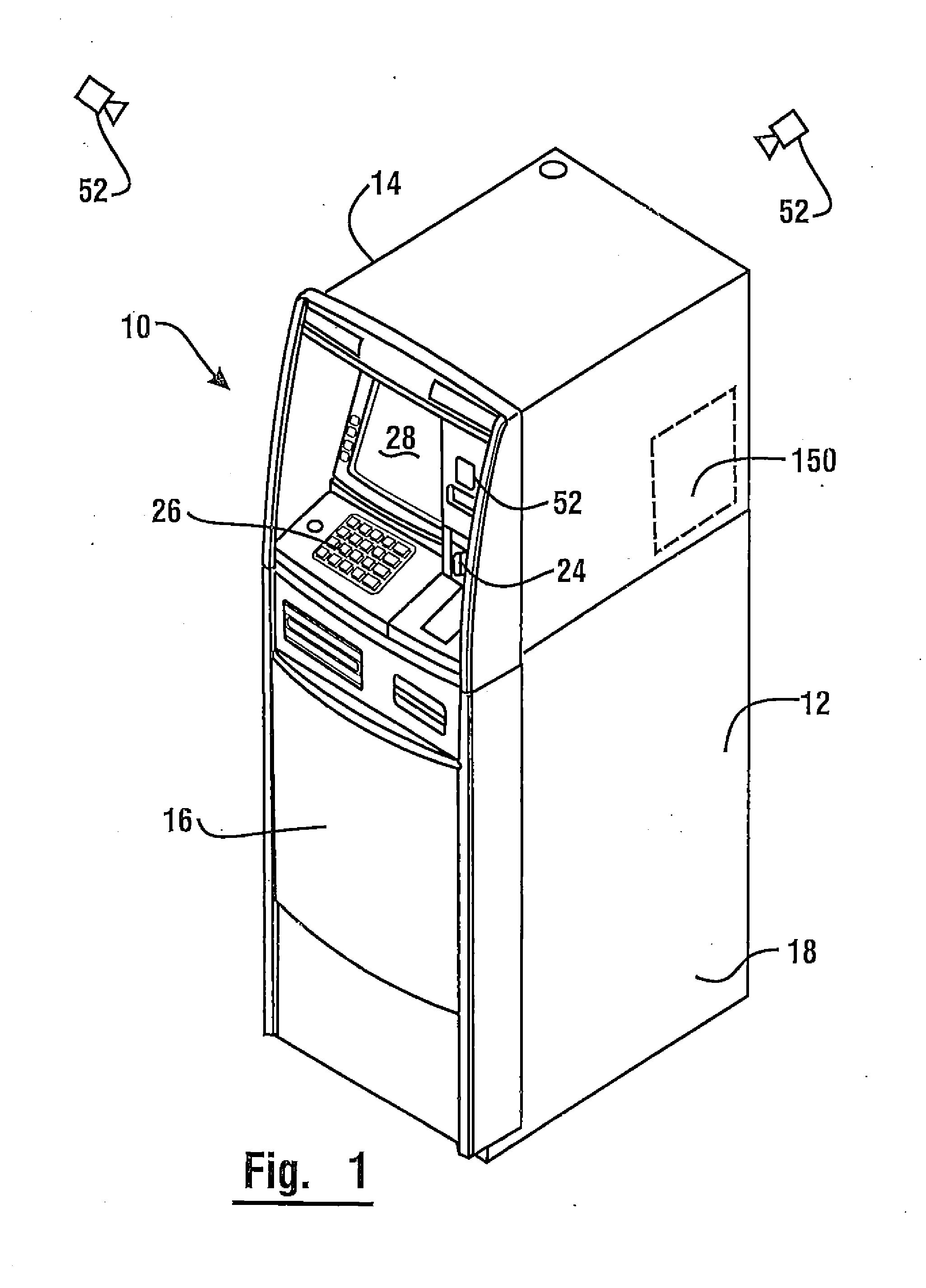

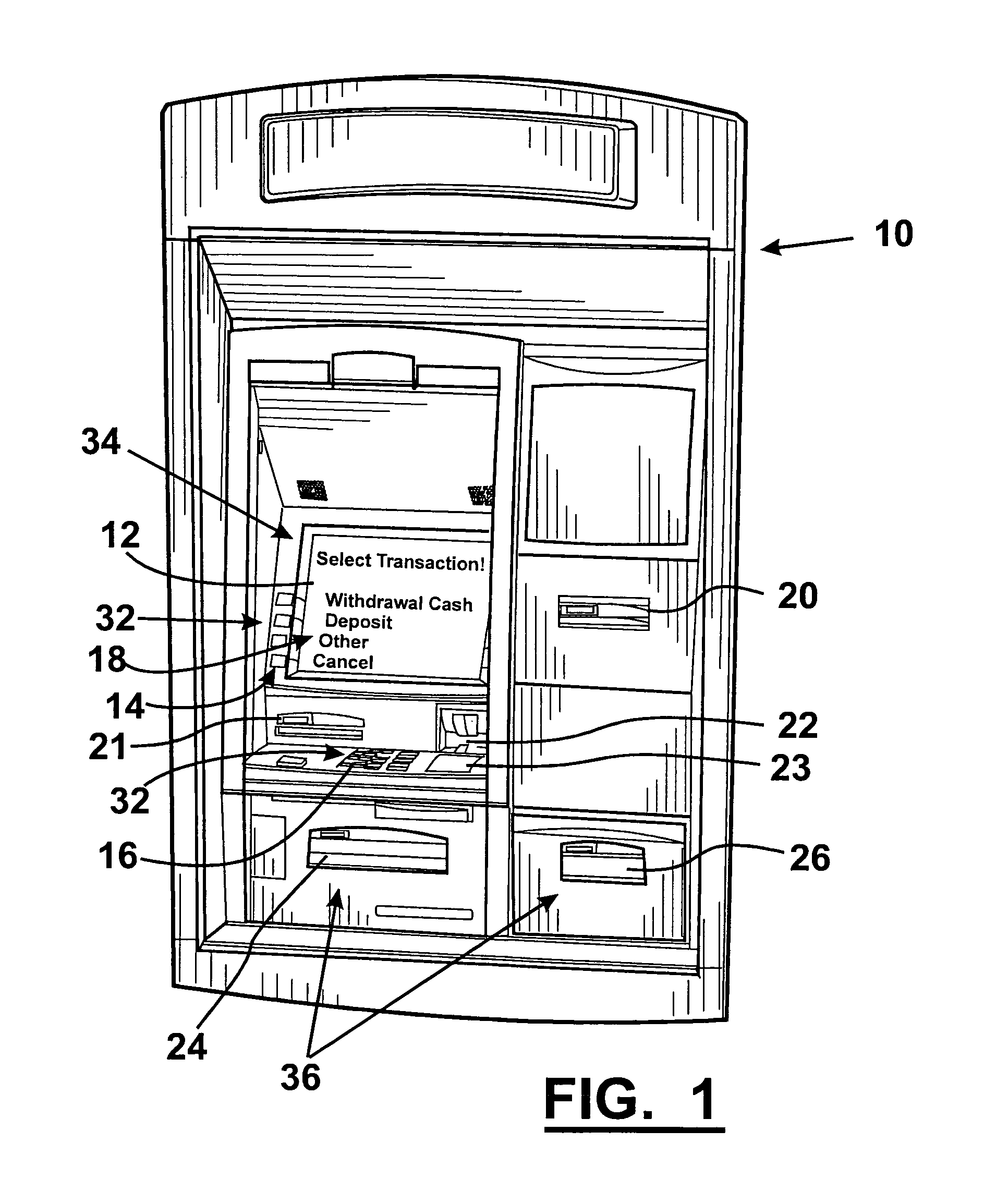

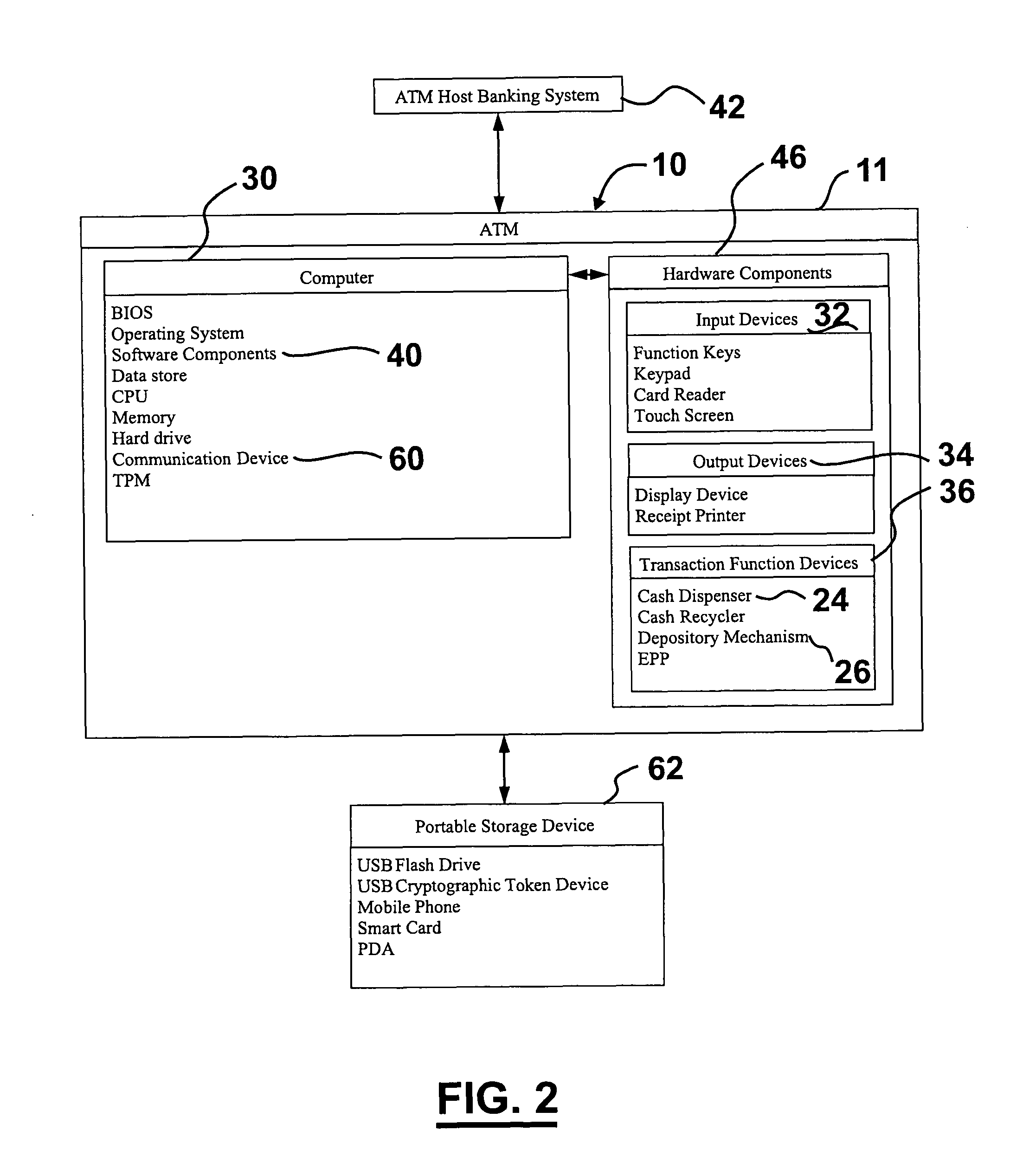

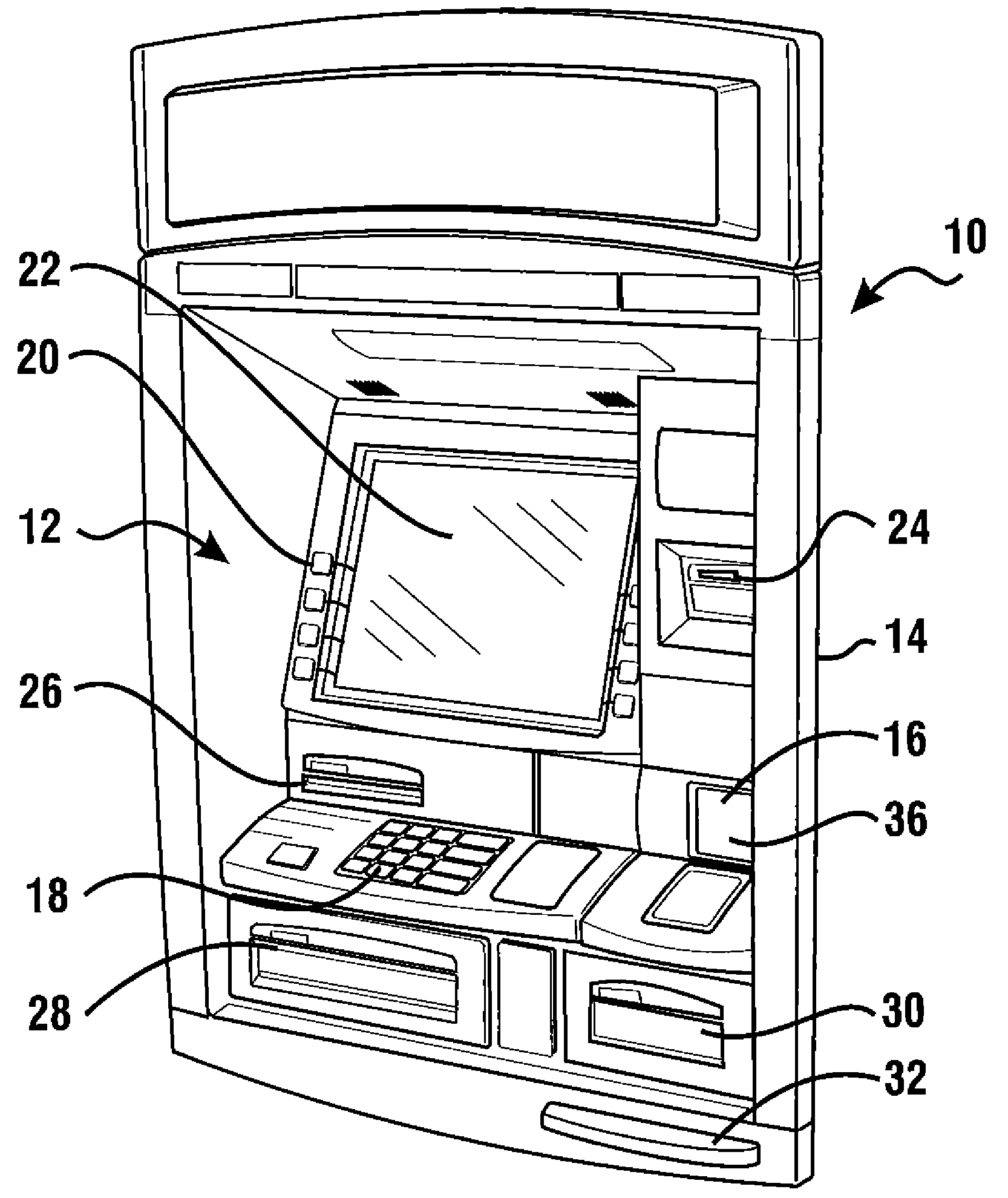

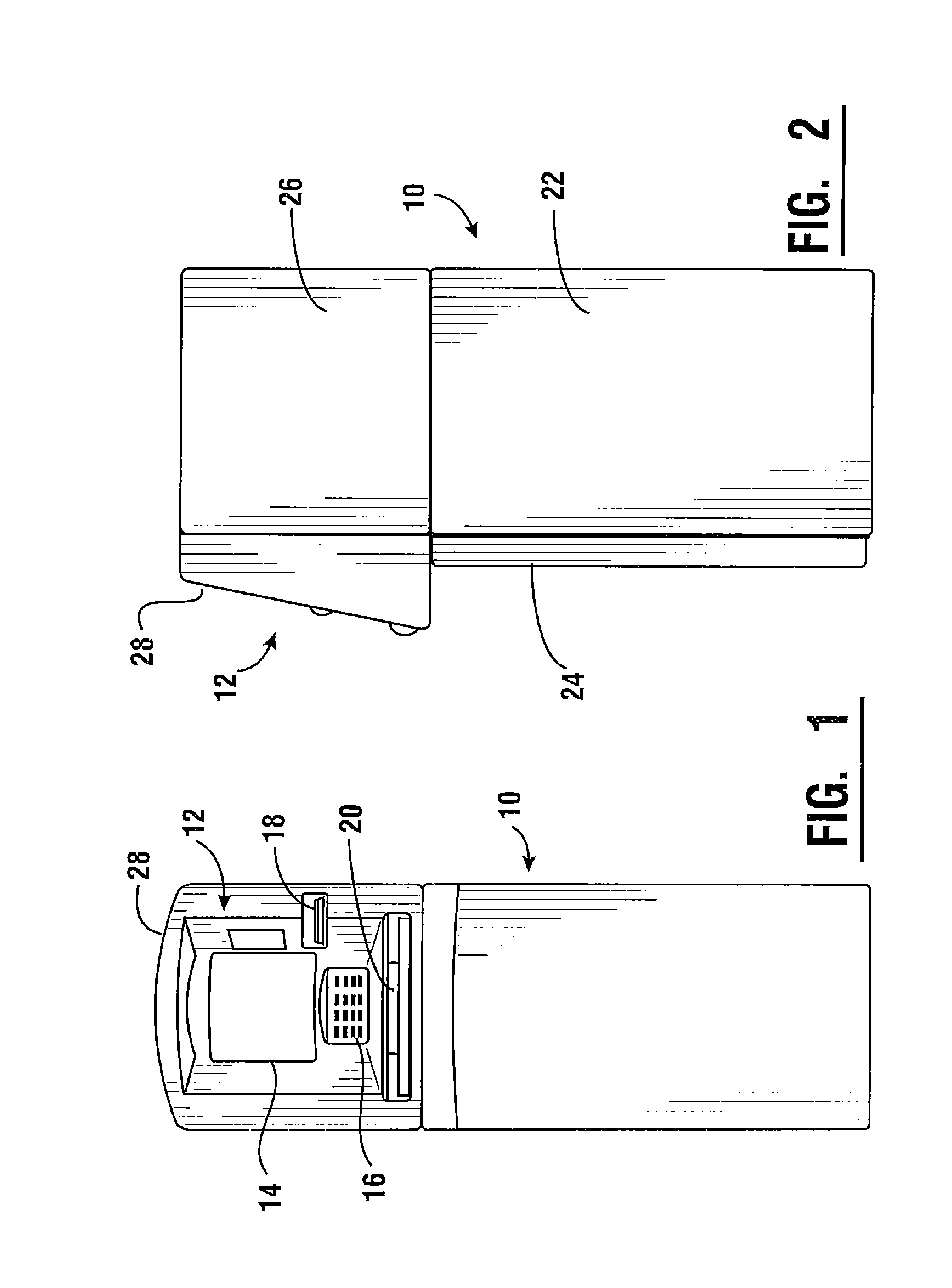

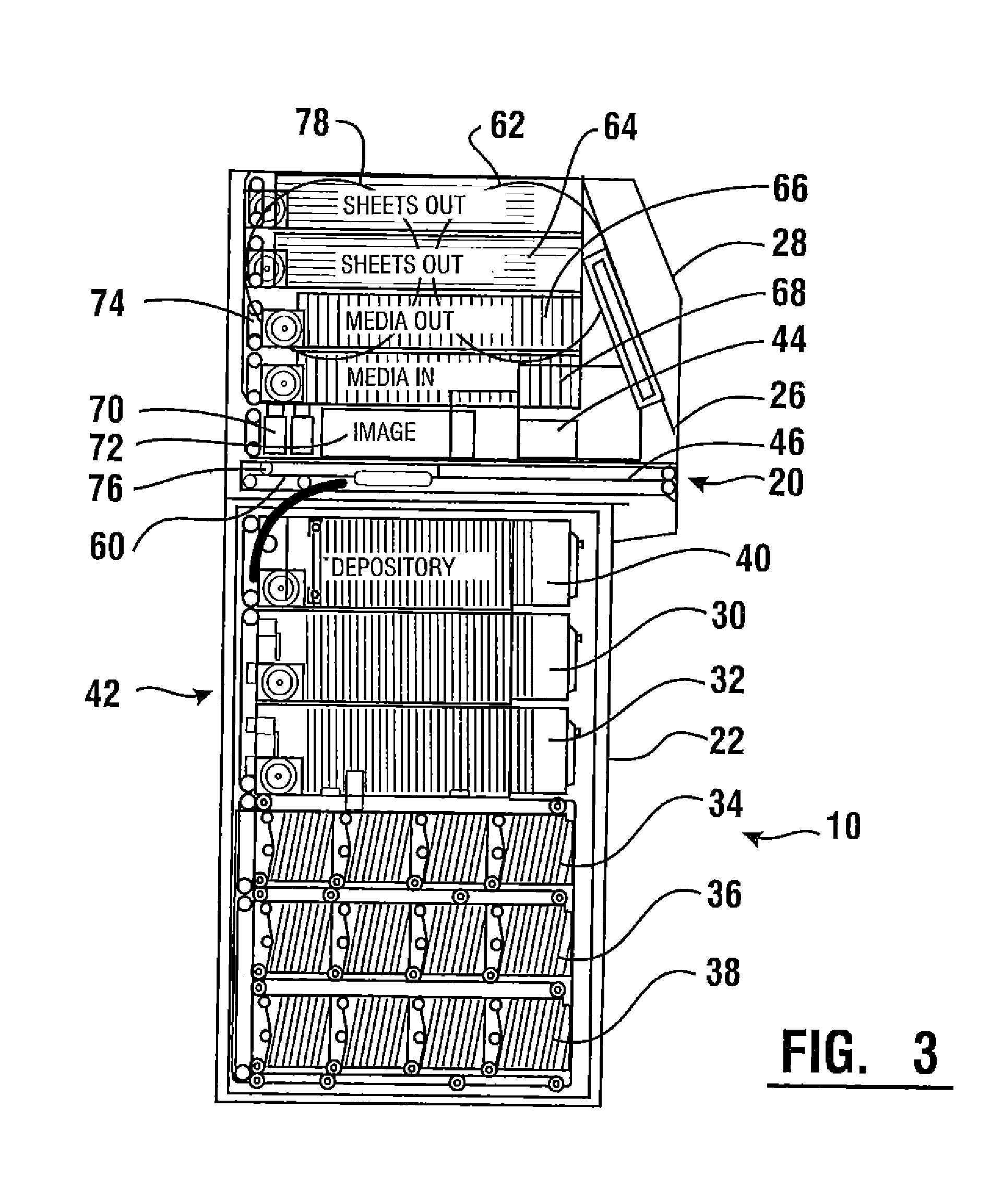

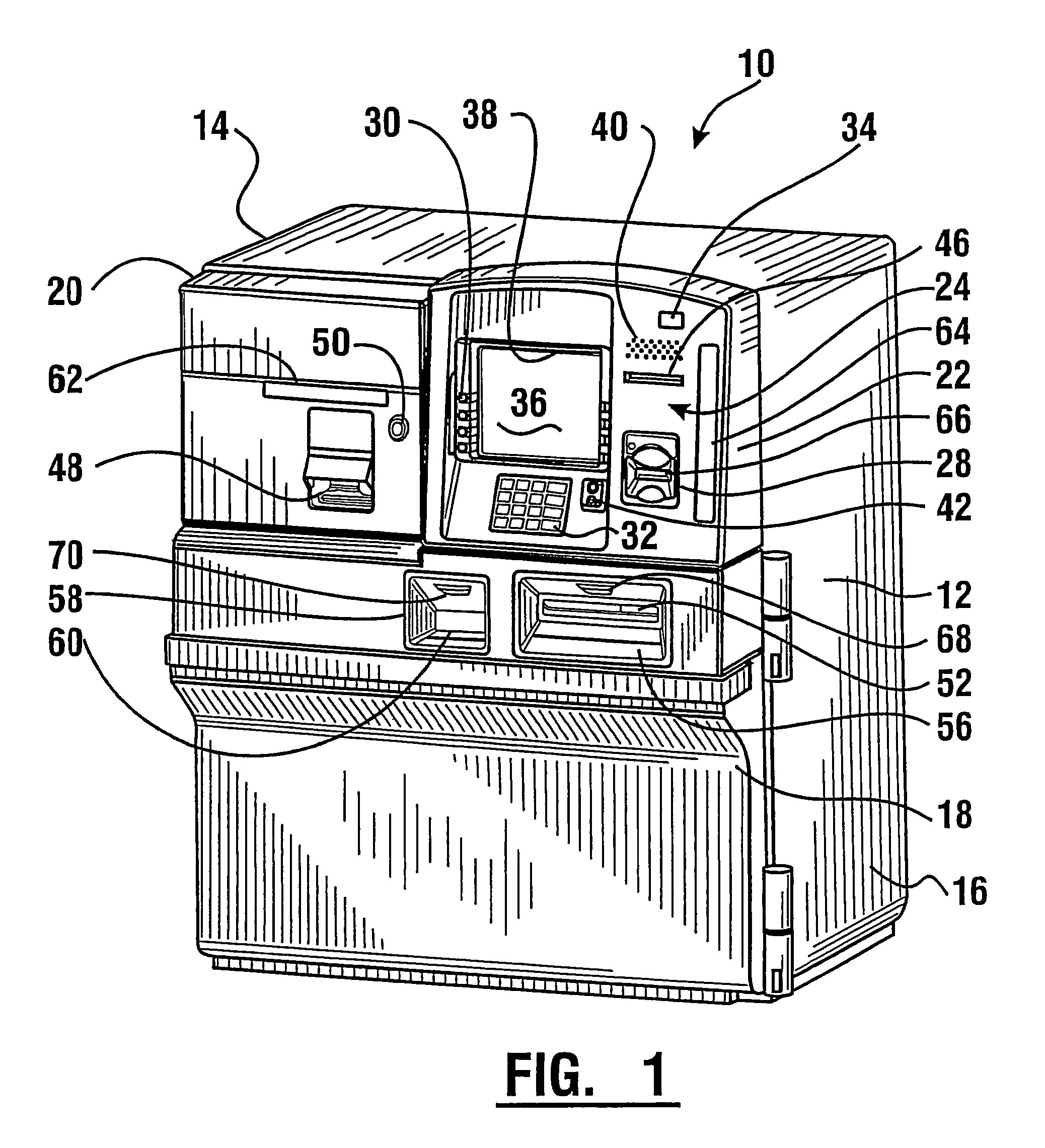

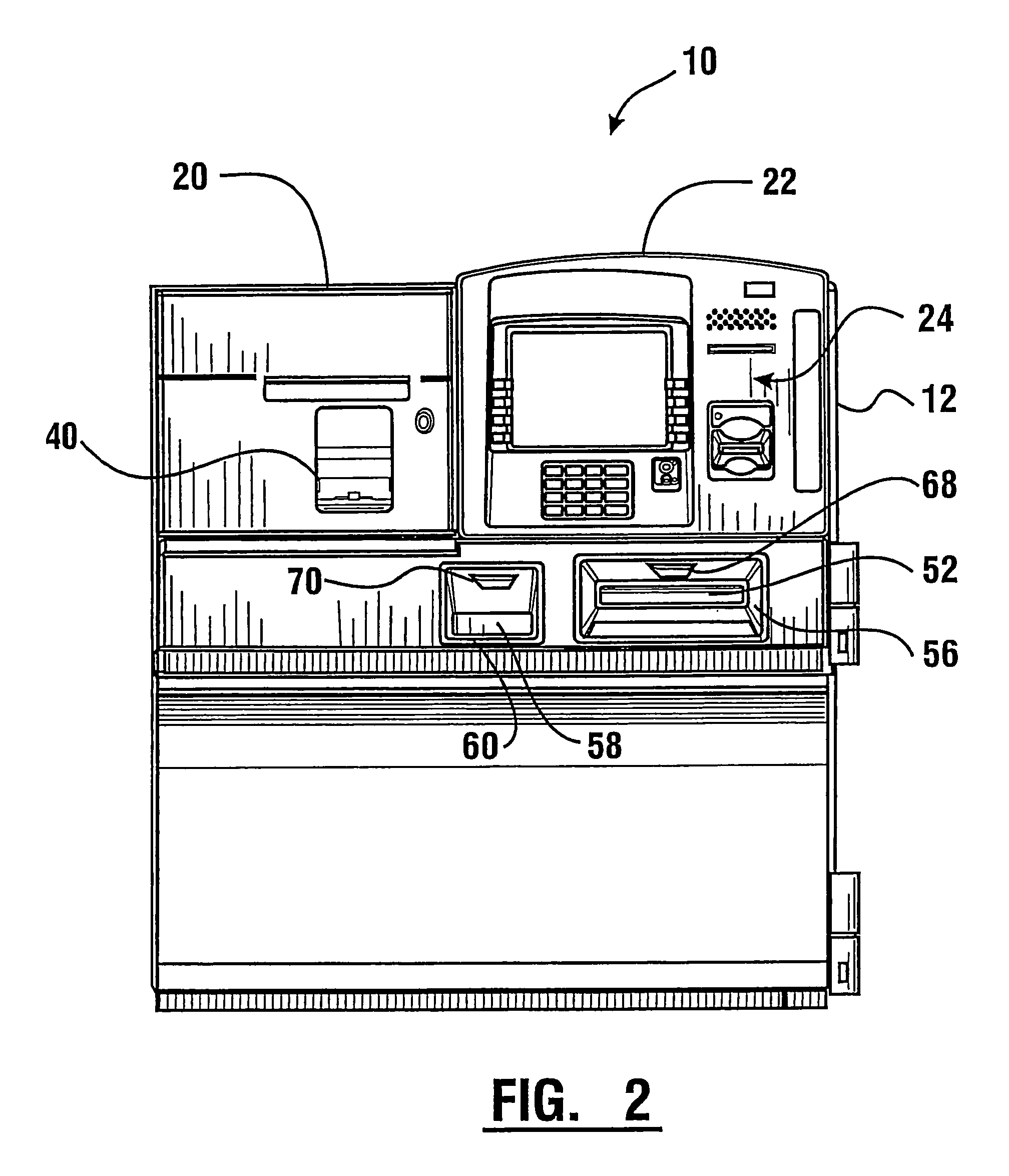

Check cashing automated banking machine

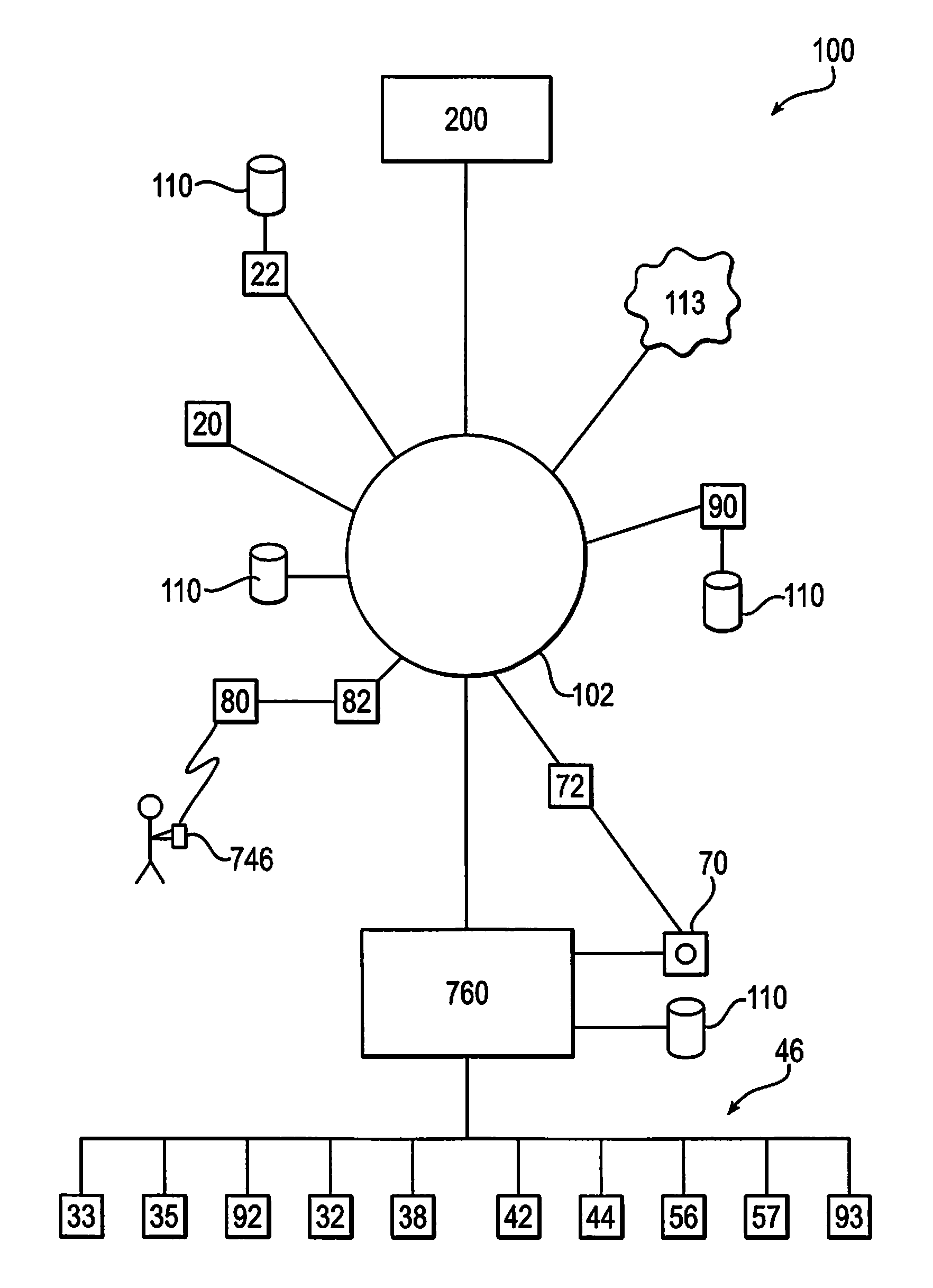

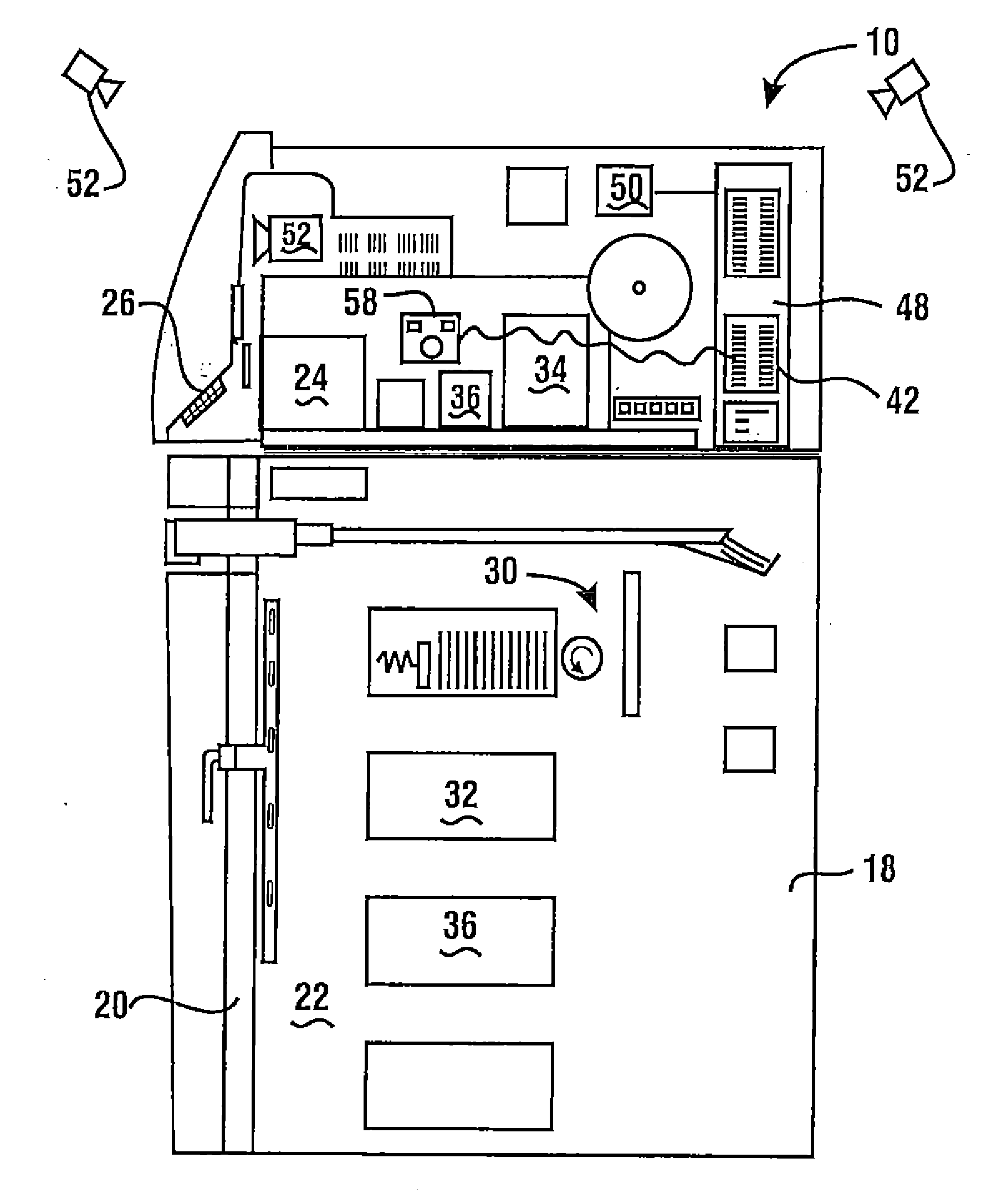

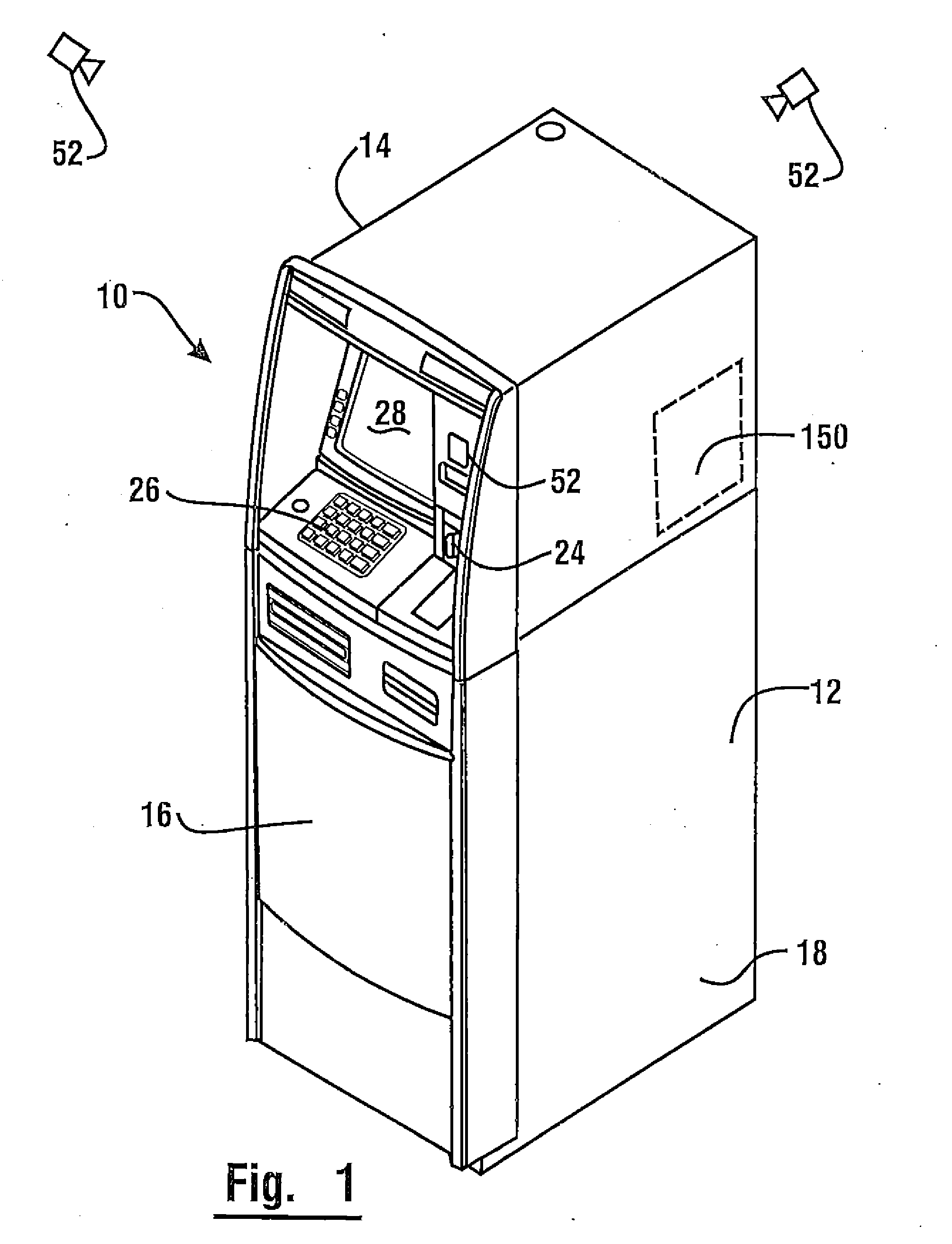

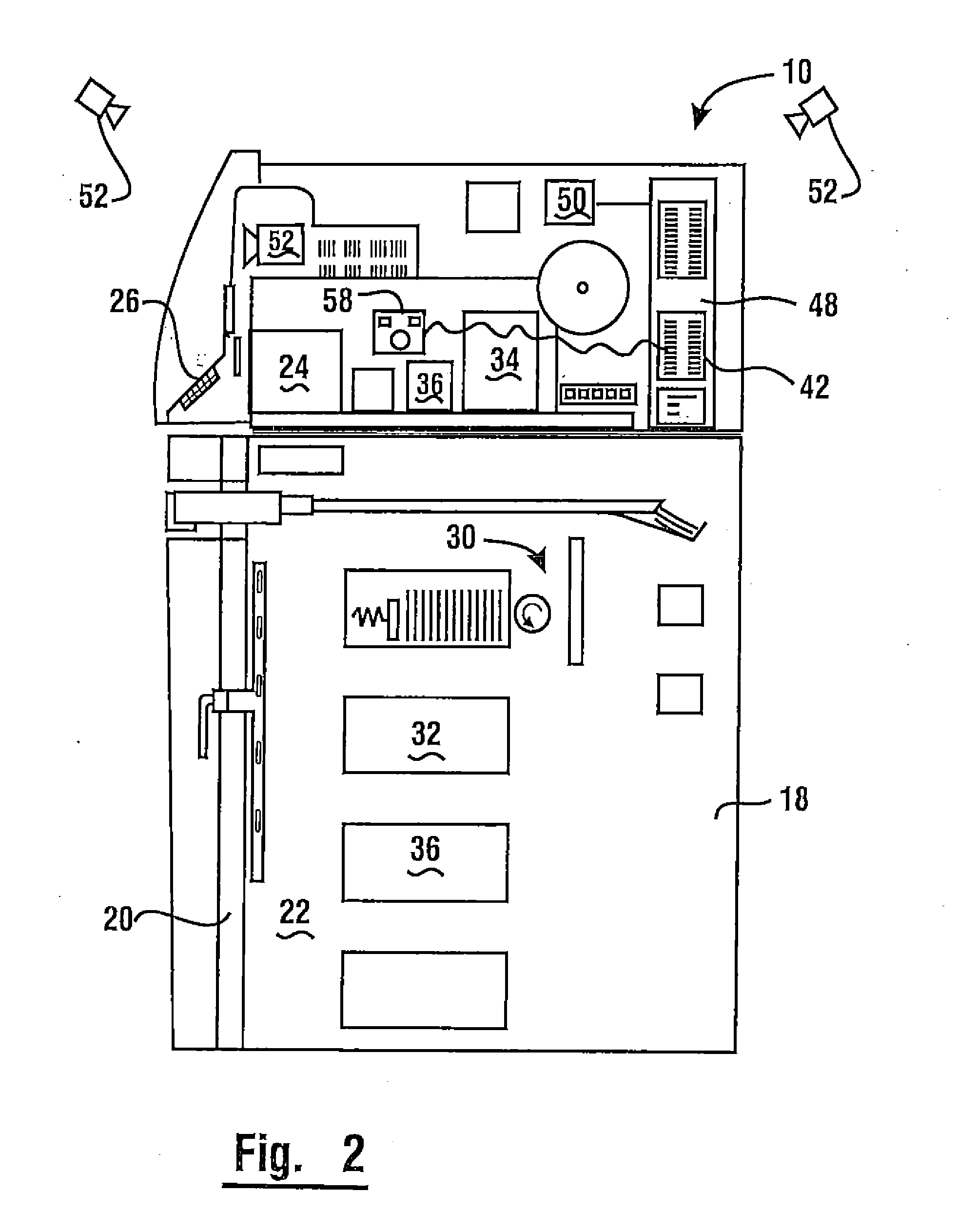

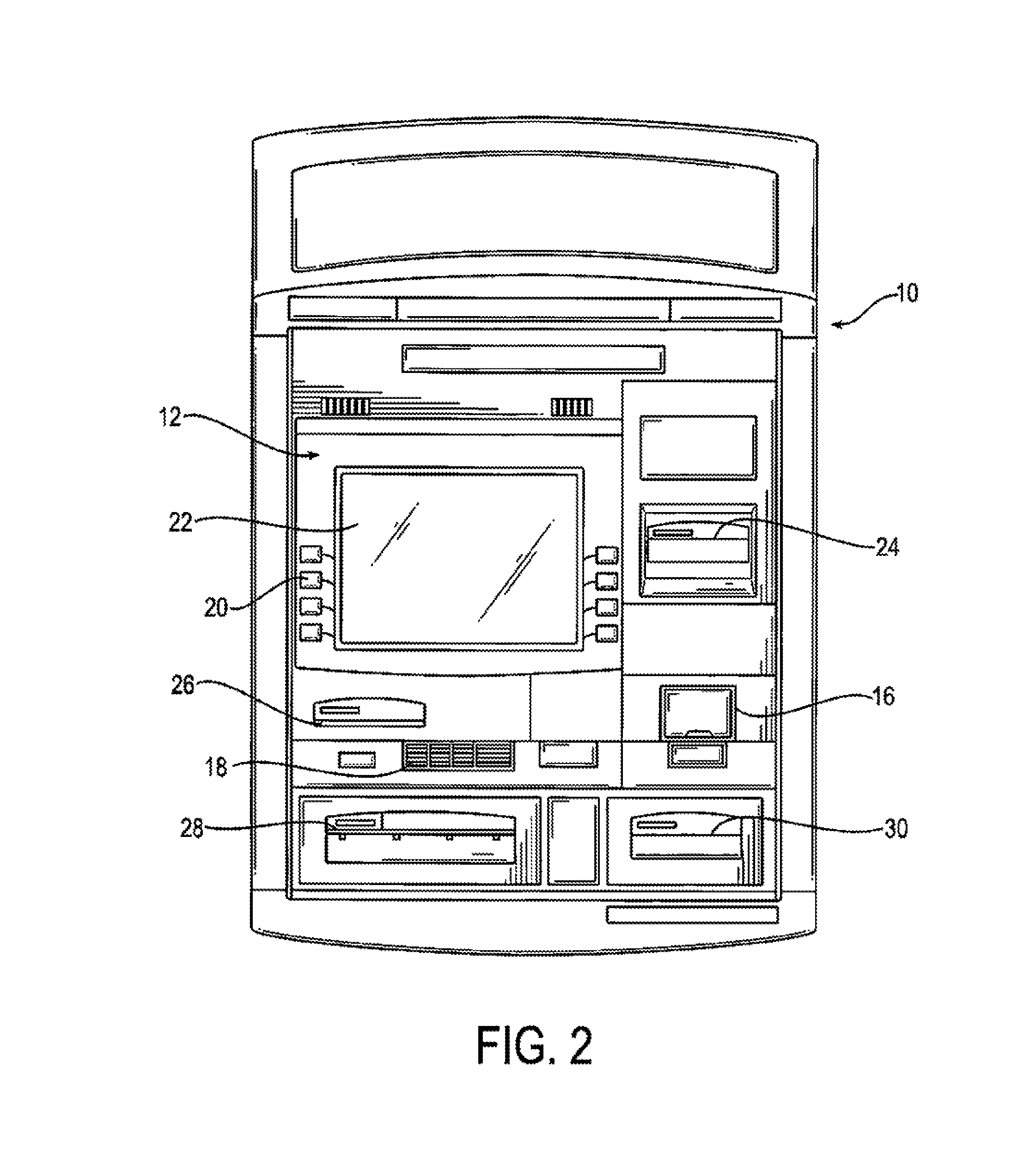

An automated banking machine is operated at least in part to data read from data bearing records. The machine is operative to carry out a financial transfer responsive at least in part to a determination that data read through a card reader of the machine corresponds to a financial account that is authorized to conduct a transaction through operation of the machine. The machine also includes a check acceptor operative to receive checks from machine users. The check acceptor is operative image checks and data resolved from check images is used in operation of the machine to cause financial transfers.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

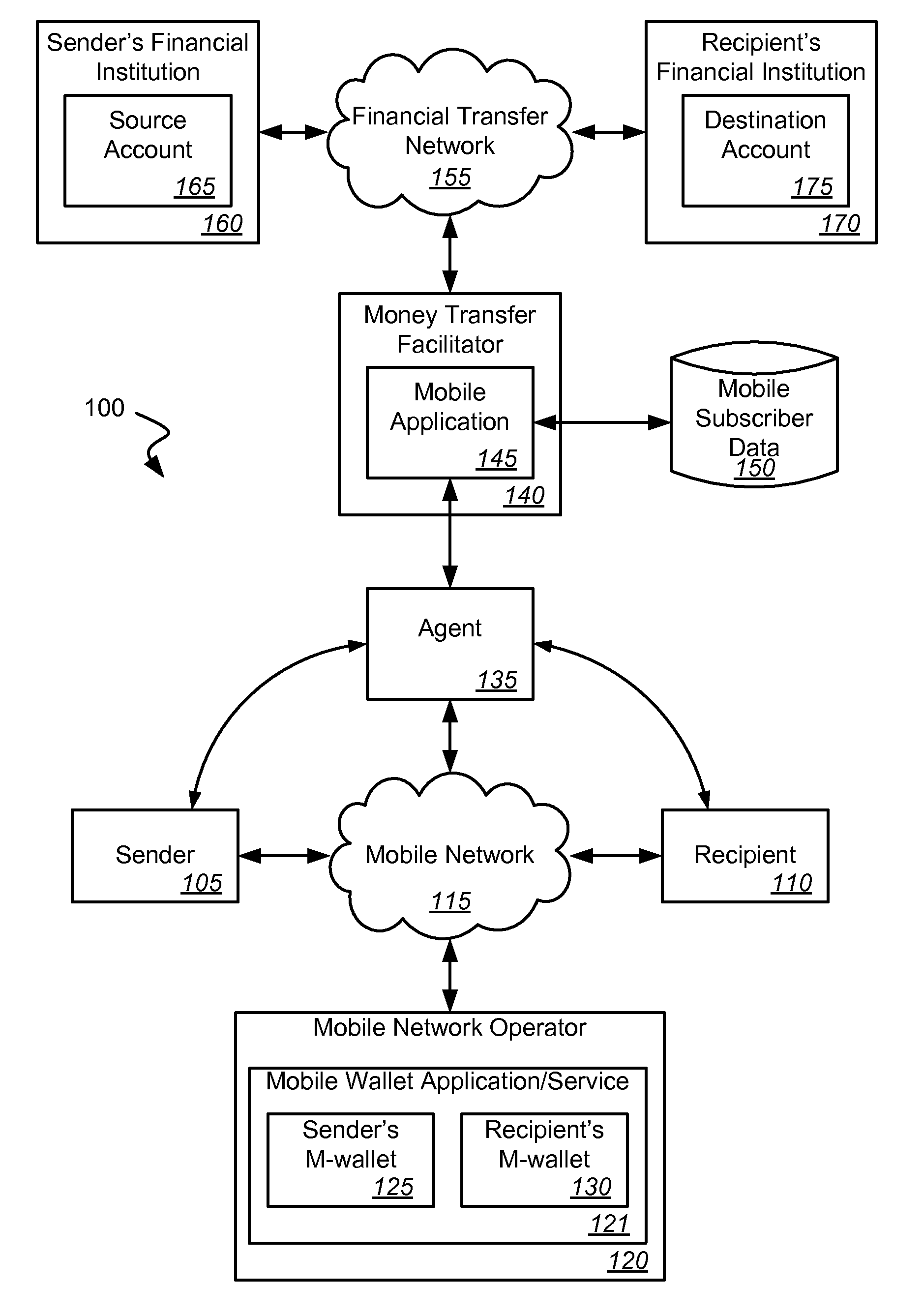

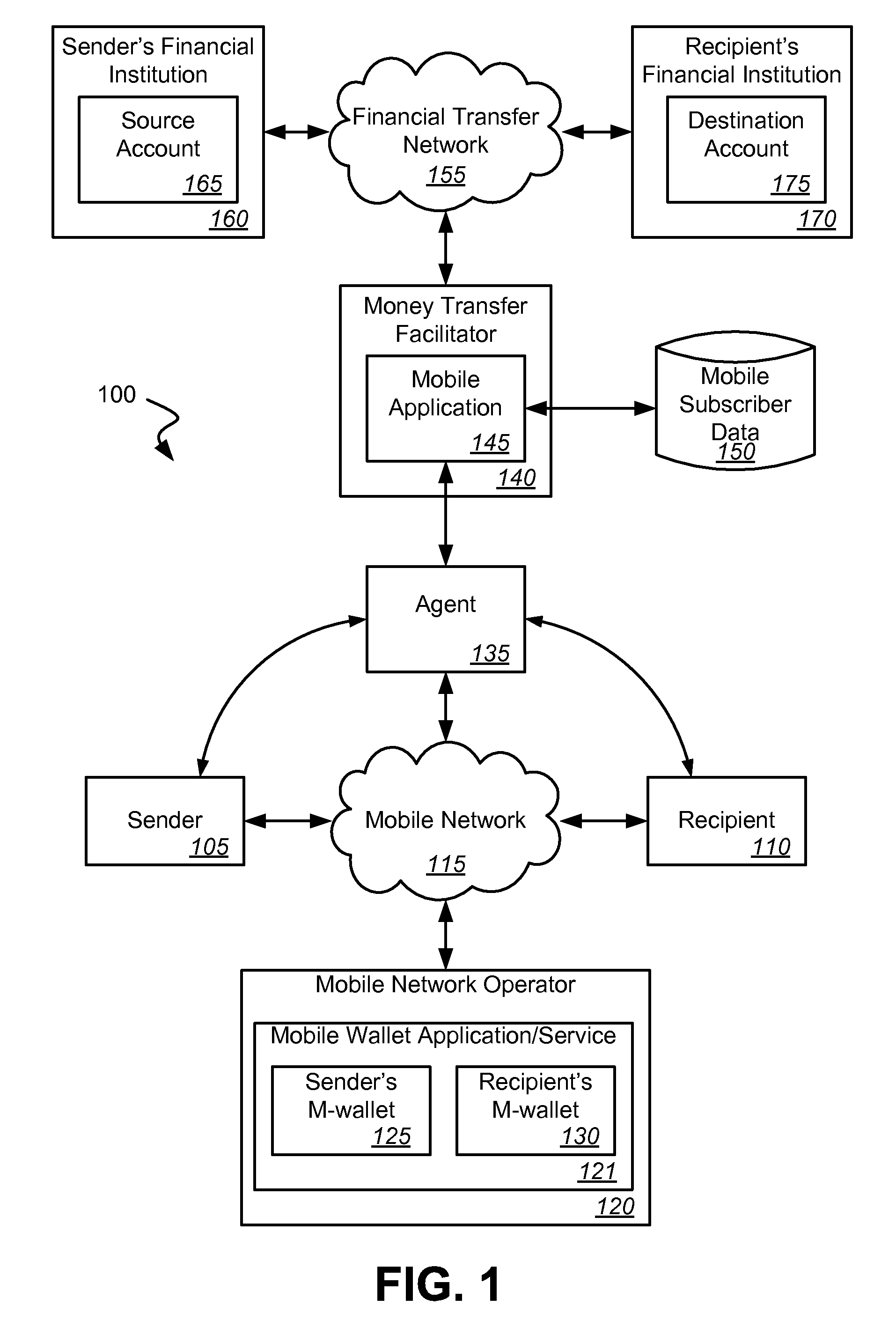

Money transfers utilizing a unique receiver identifier

Methods, systems, and machine-readable media are disclosed for financial transfers utilizing a unique identifier to facilitate flexible payment options for the transaction. According to one embodiment, a pull transaction model can be implemented. According to such embodiments, a money transfer can be initiated in a conventional manner via an agent of a money transfer facilitator. The sender of the transfer can provide an identifier for the transaction to the recipient. The recipient can in turn use the identifier, in combination with functionality of a mobile wallet application of a mobile device to request or “pull” the money transfer to an account associated with the mobile wallet application. In this way, the recipient can receive the transfer to the mobile wallet account even if the sender does not know that such a delivery is available.

Owner:THE WESTERN UNION CO

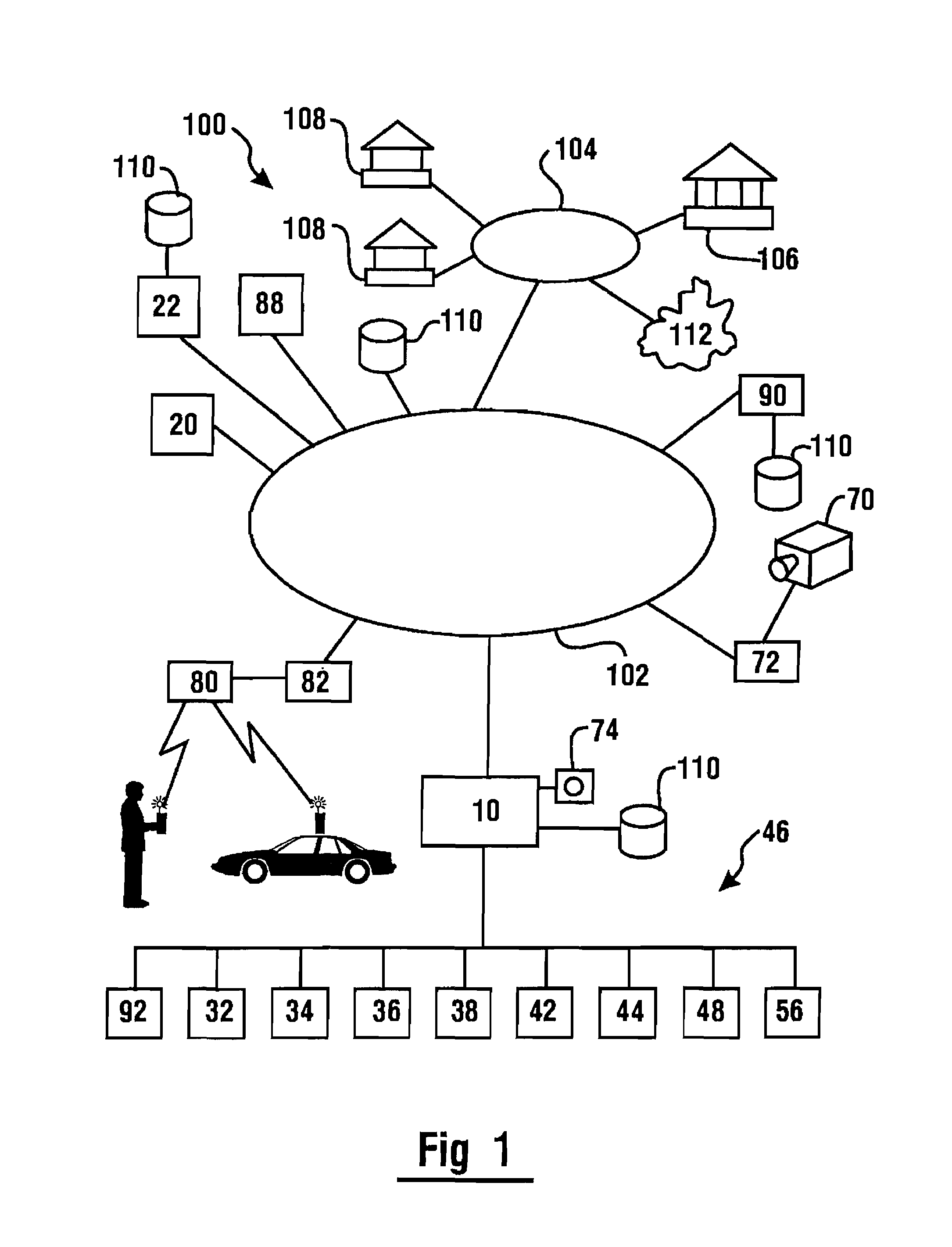

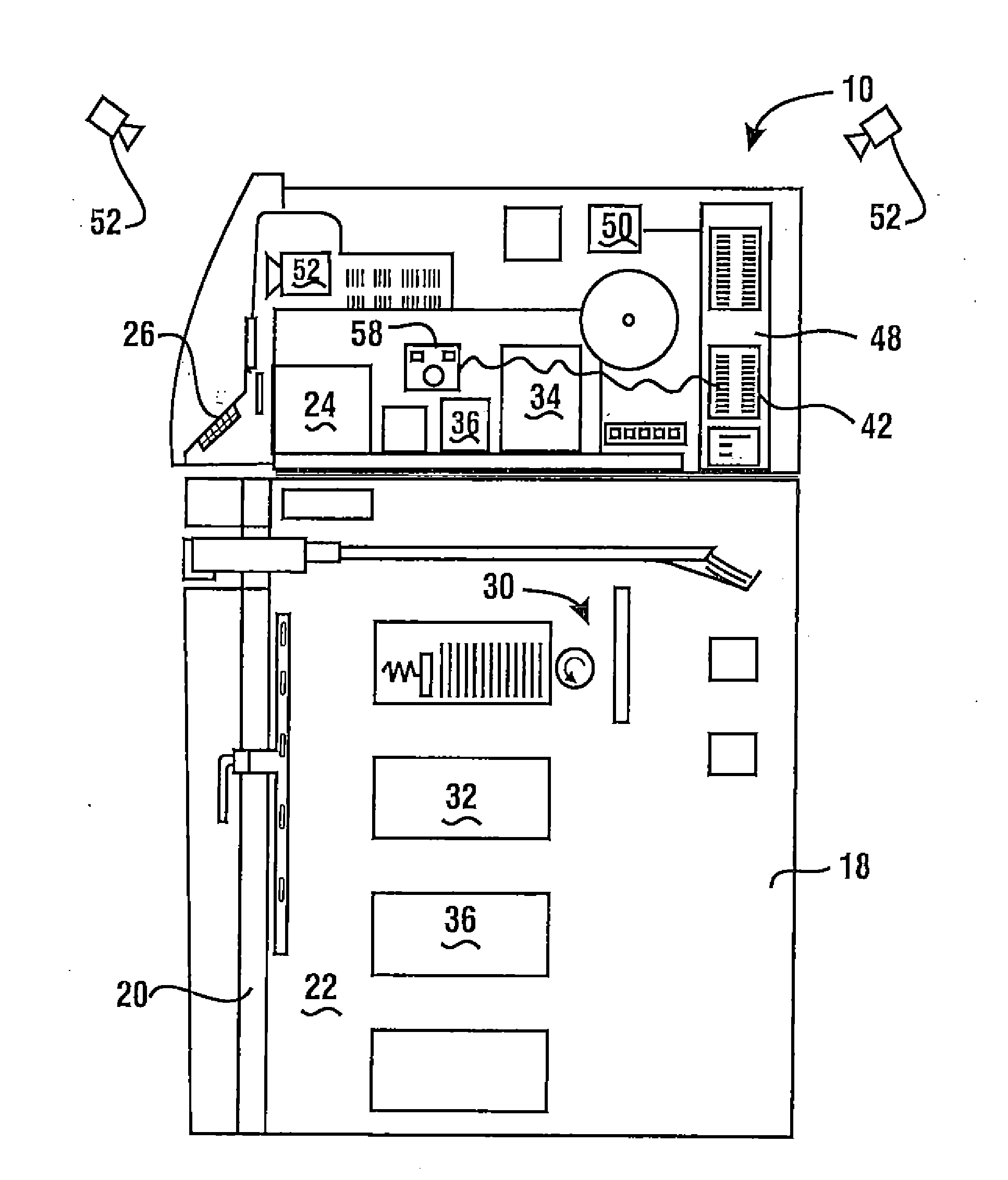

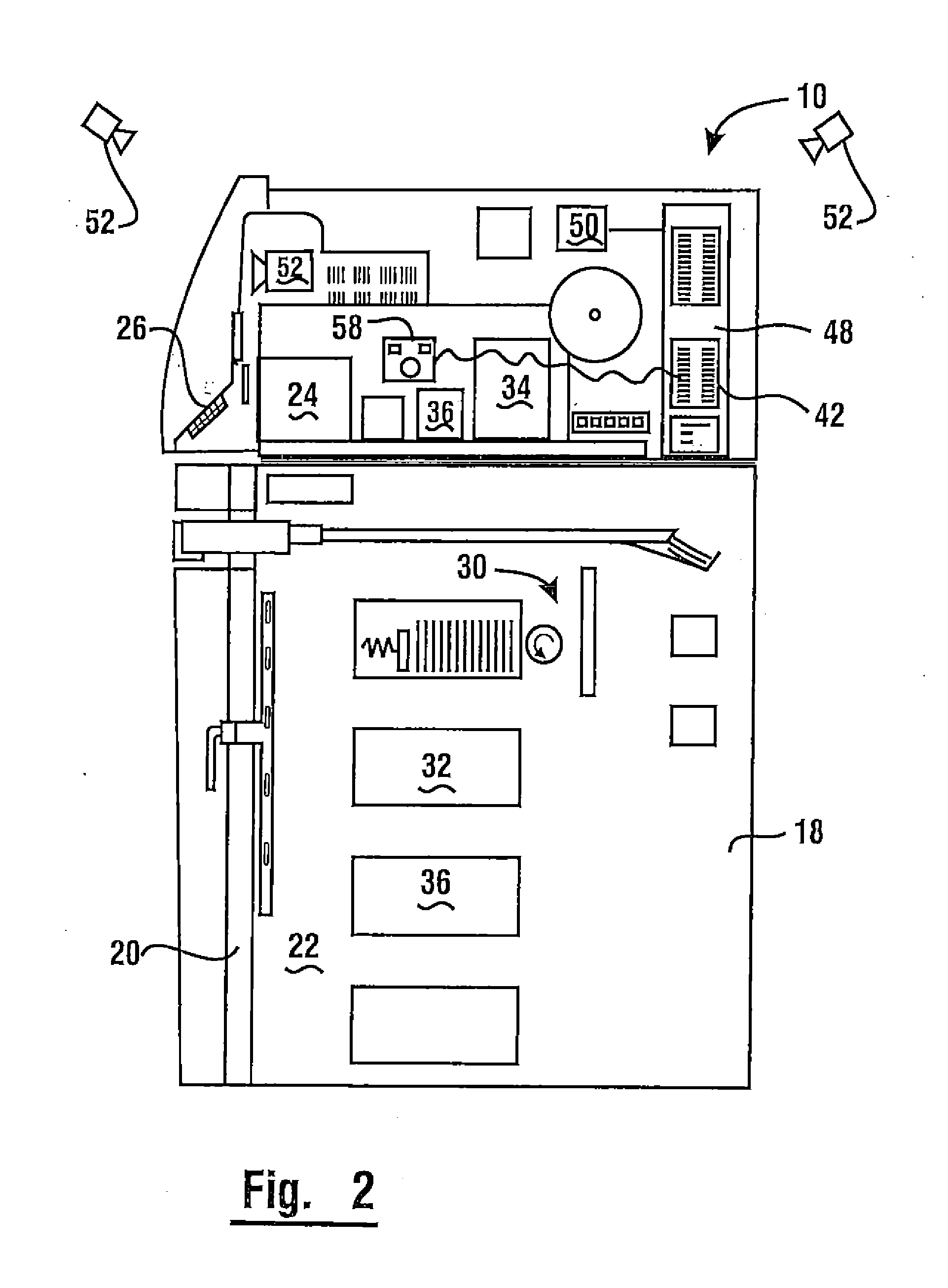

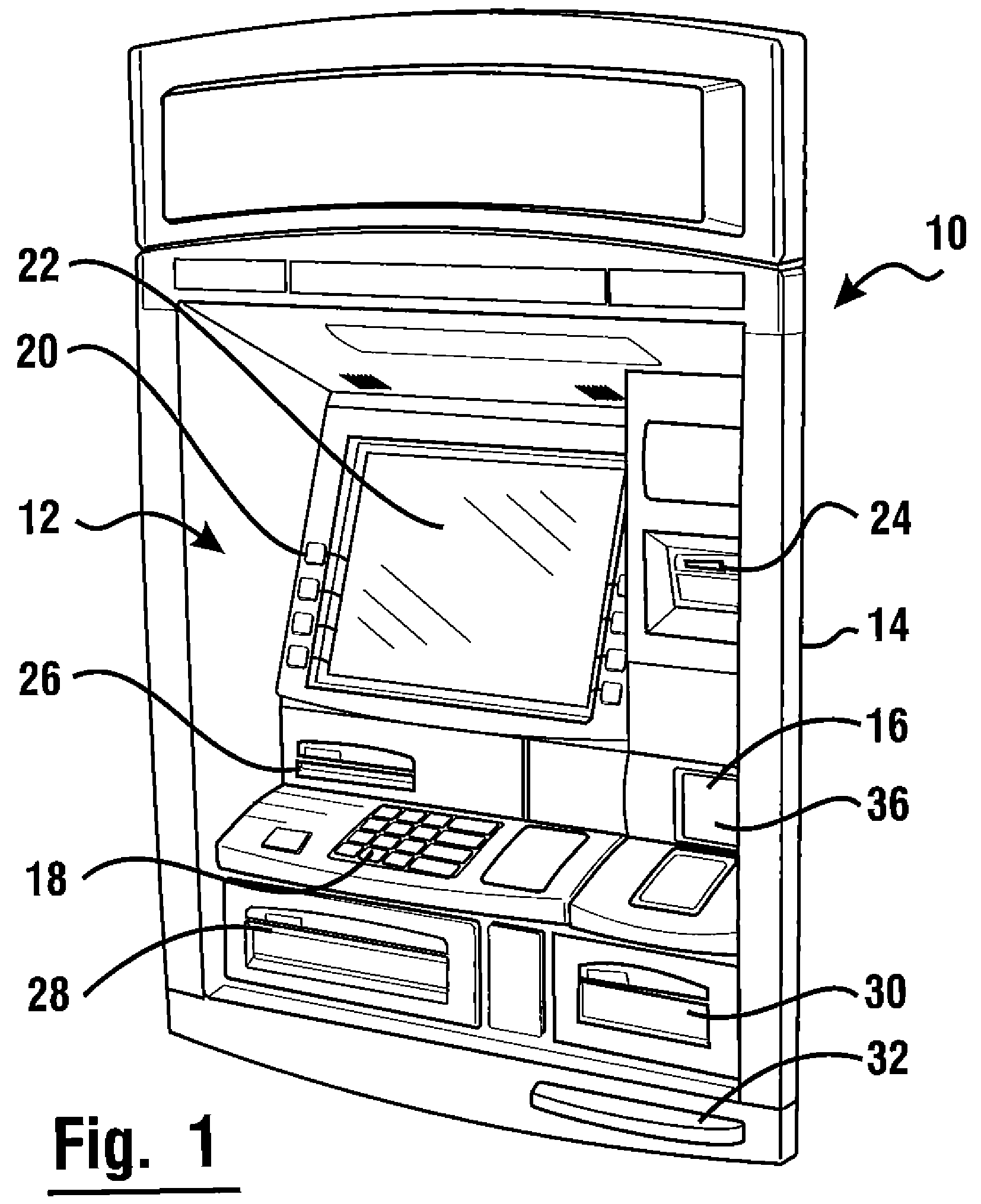

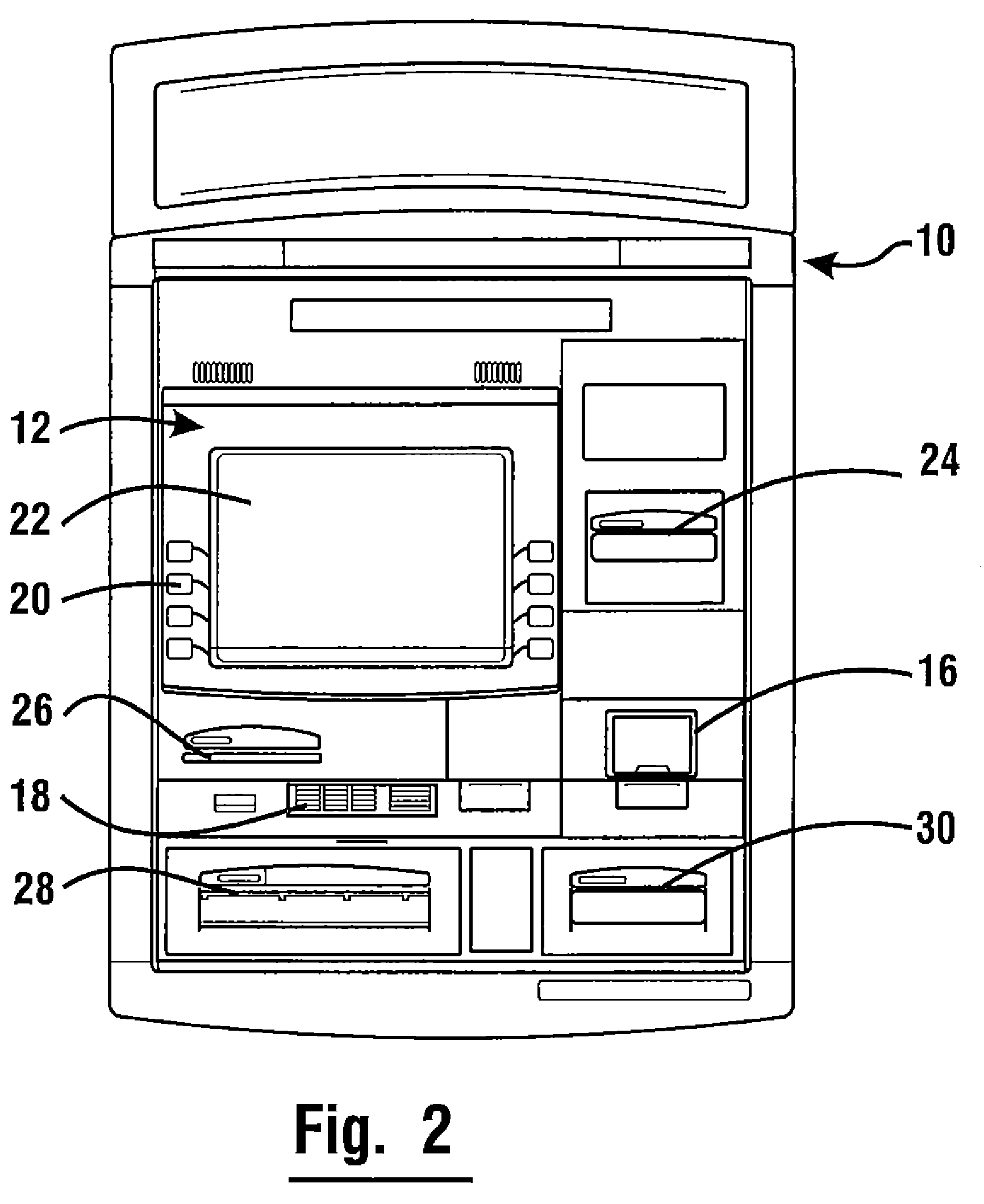

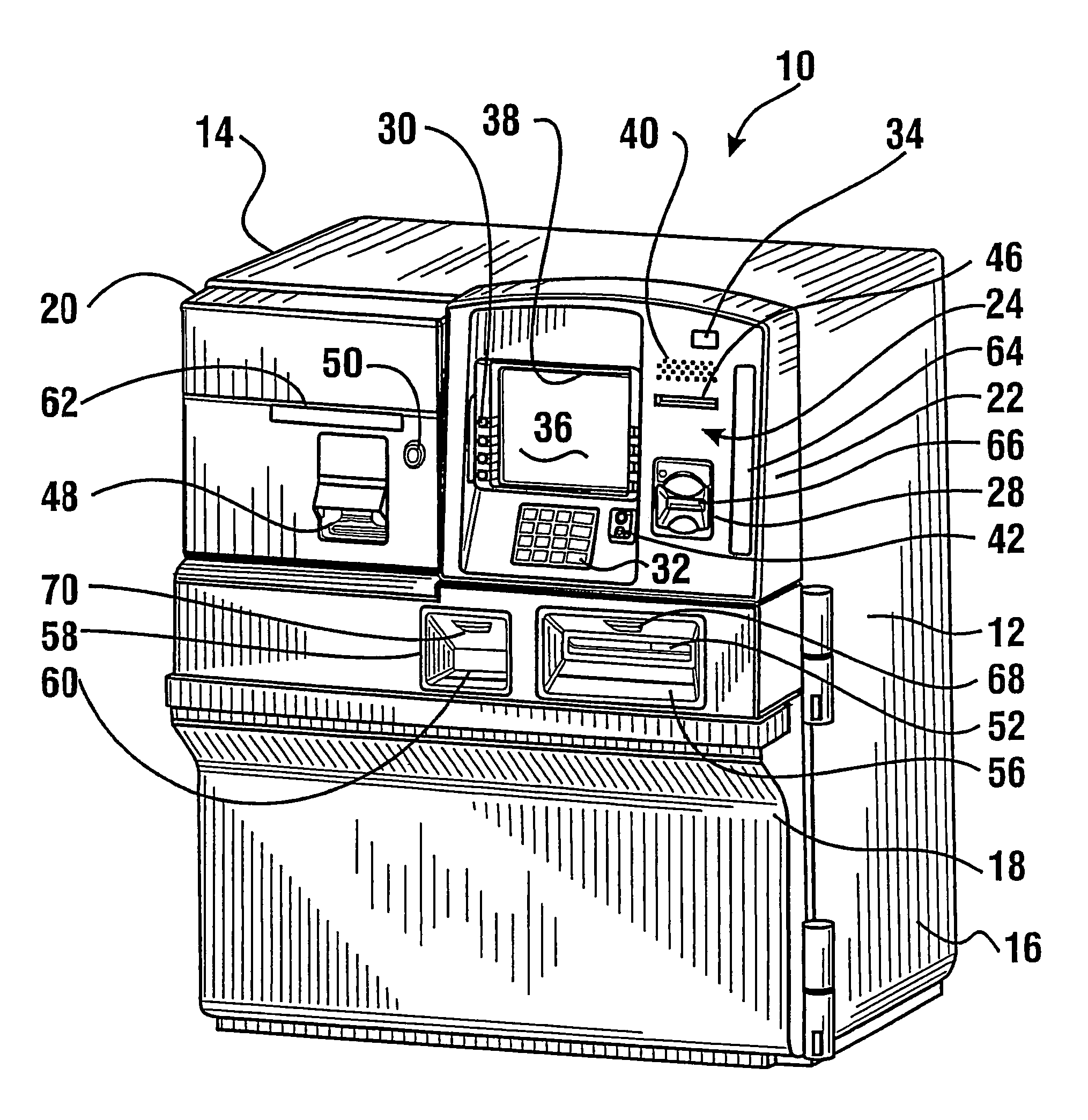

Automated banking system controlled responsive to data bearing records

ActiveUS7959072B1Improved operating and servicingSolve the lack of flexibilityPayment architectureSpecial data processing applicationsFinancial transactionCard reader

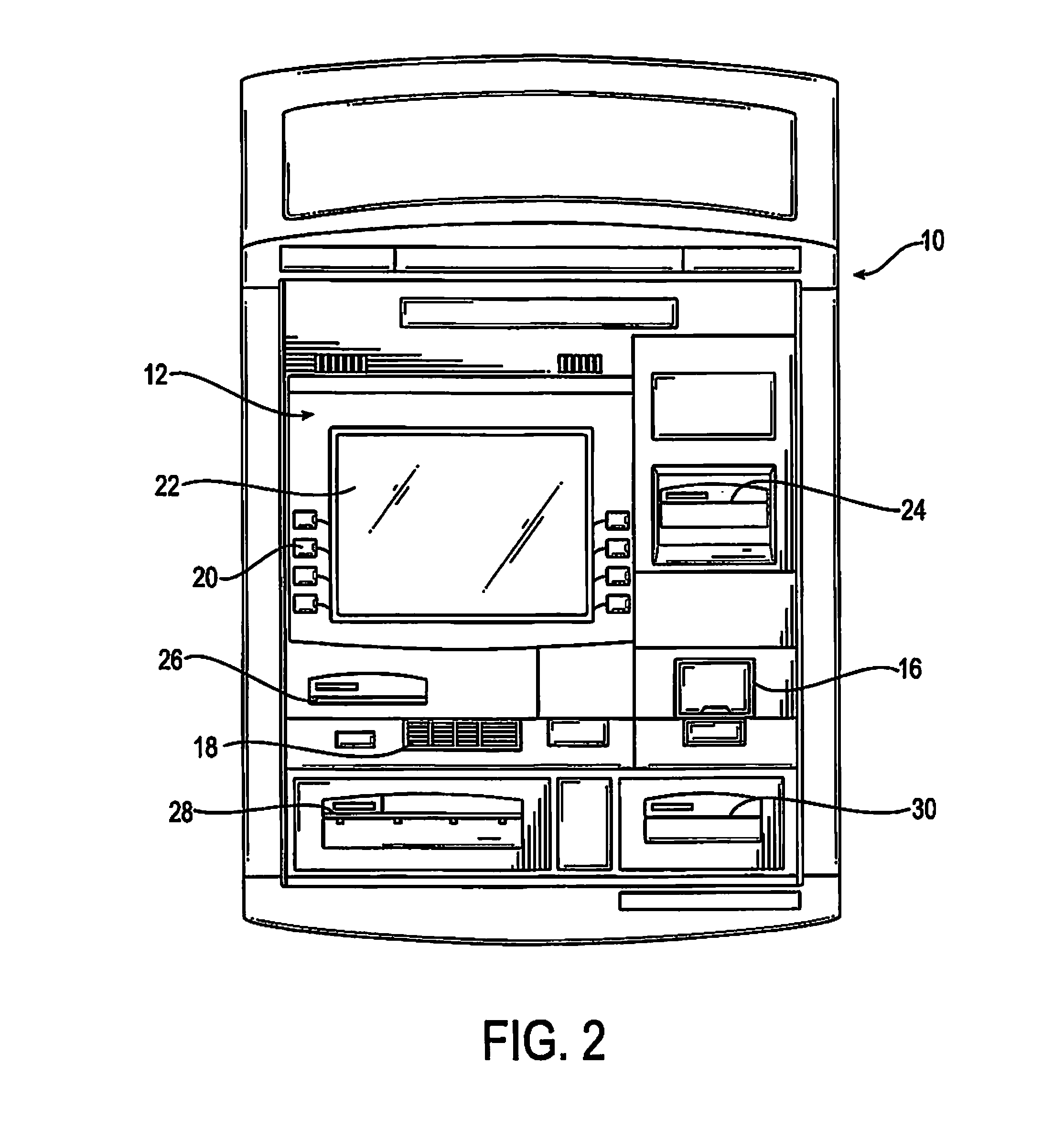

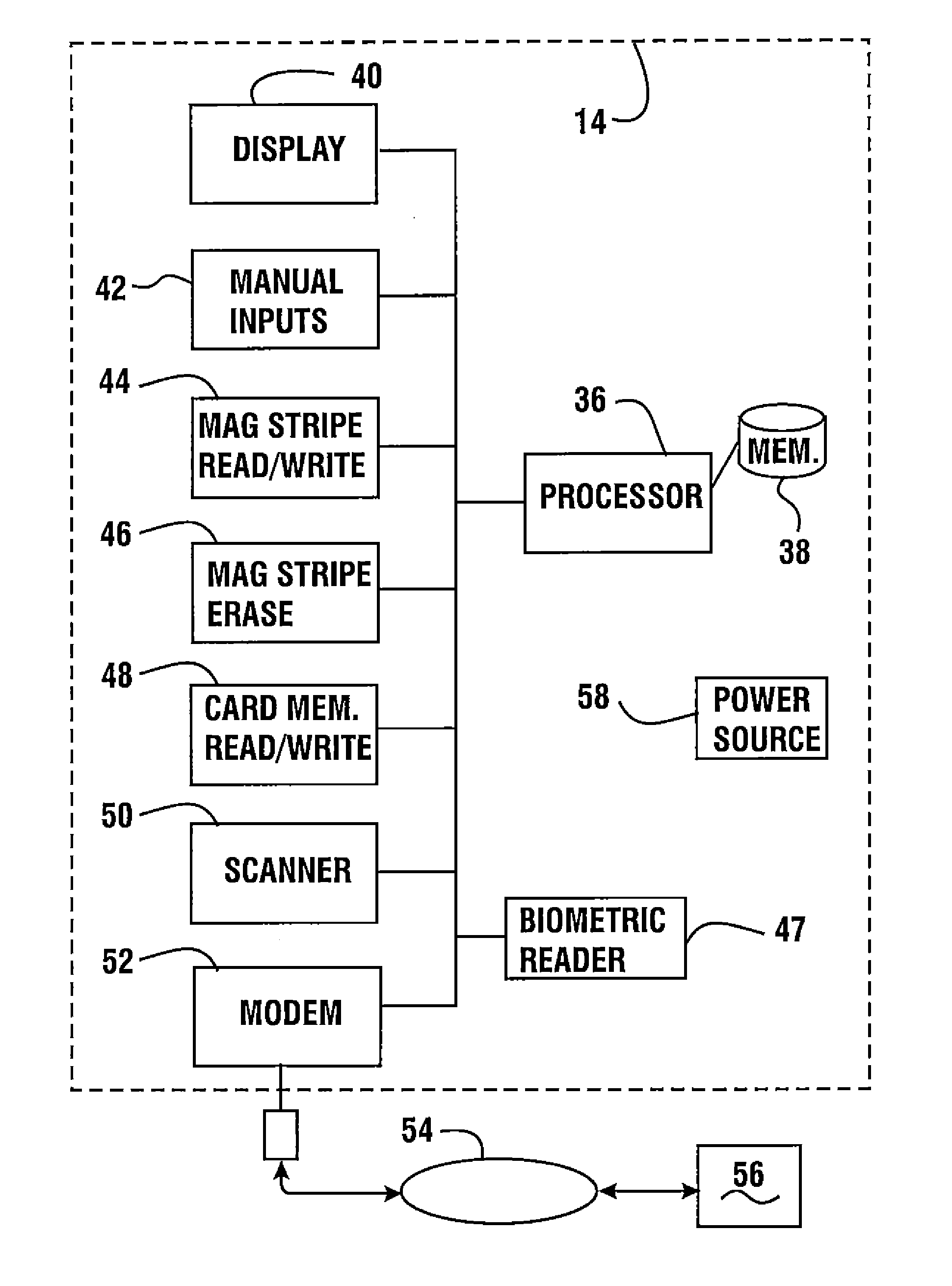

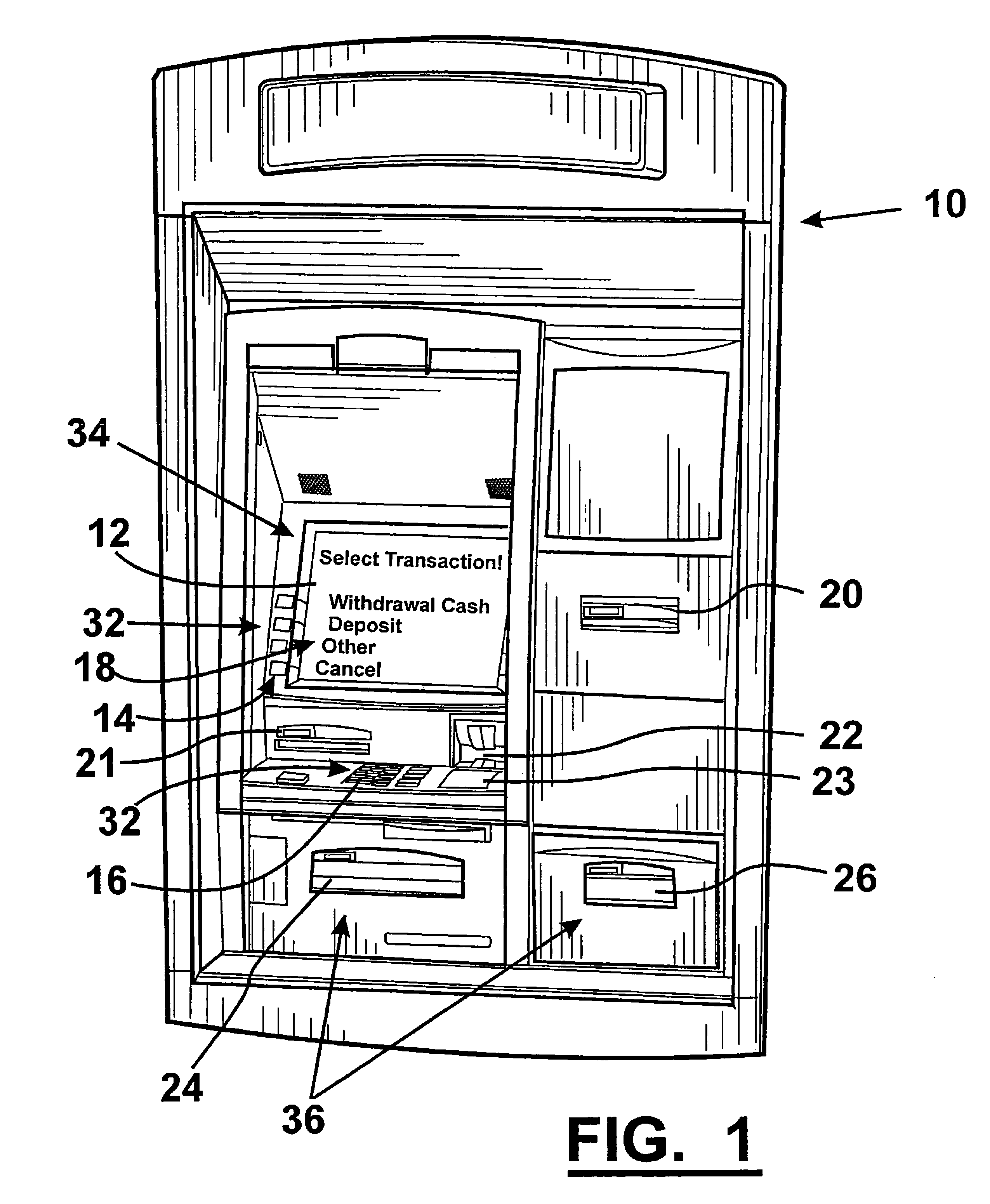

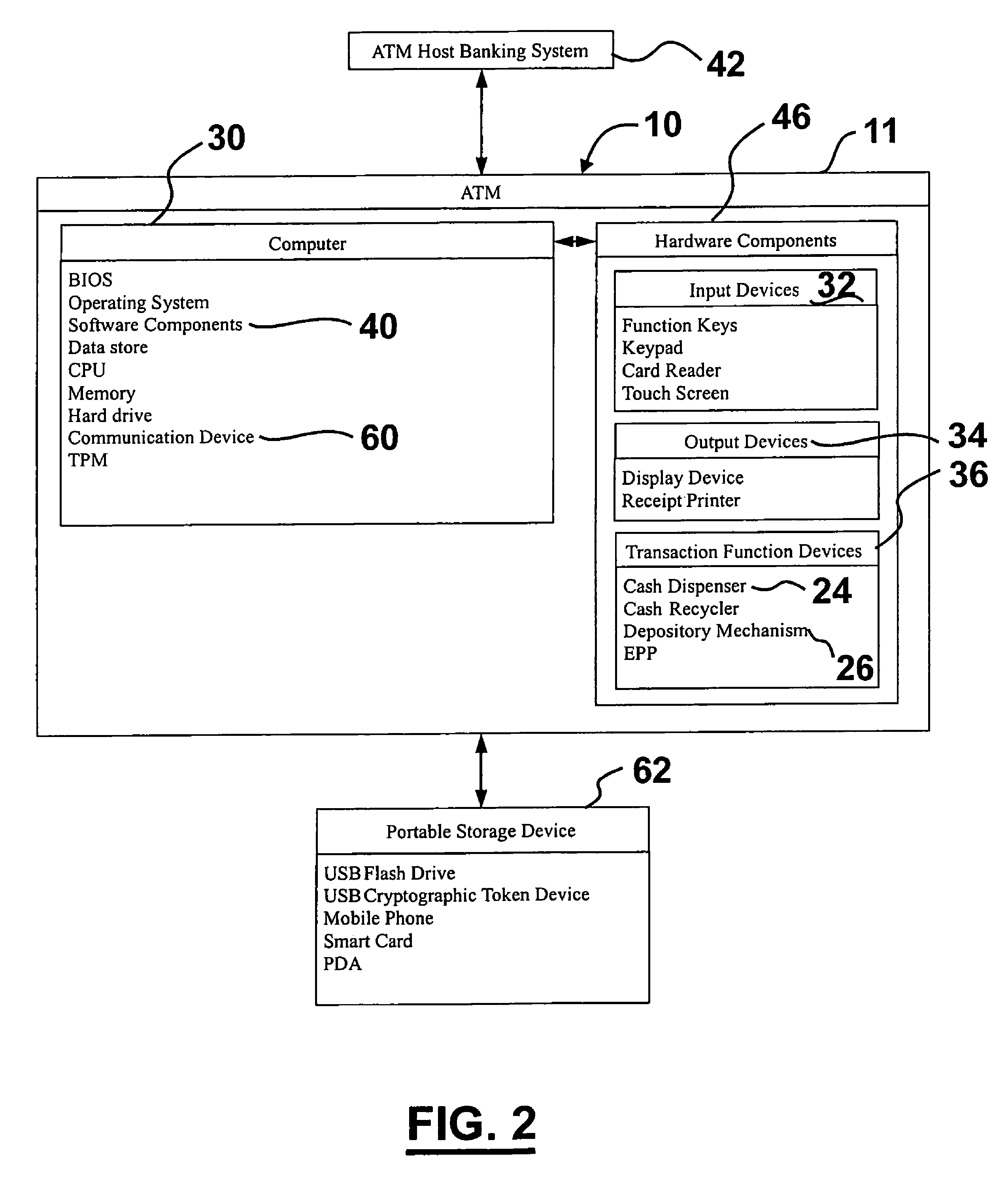

An automatic banking machine operates responsive to data bearing records. The machine includes a card reader for reading user cards, and at least one of a note acceptor and a cash dispenser. The automated banking machine carries out financial transfers related to user accounts based on information read from cards. The automated banking machine provides a printed receipt for transactions conducted. The machine carries out transactions when operatively connected to a source of power and a transaction network. The machine also carries out functions to control the power status of devices in the machine.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

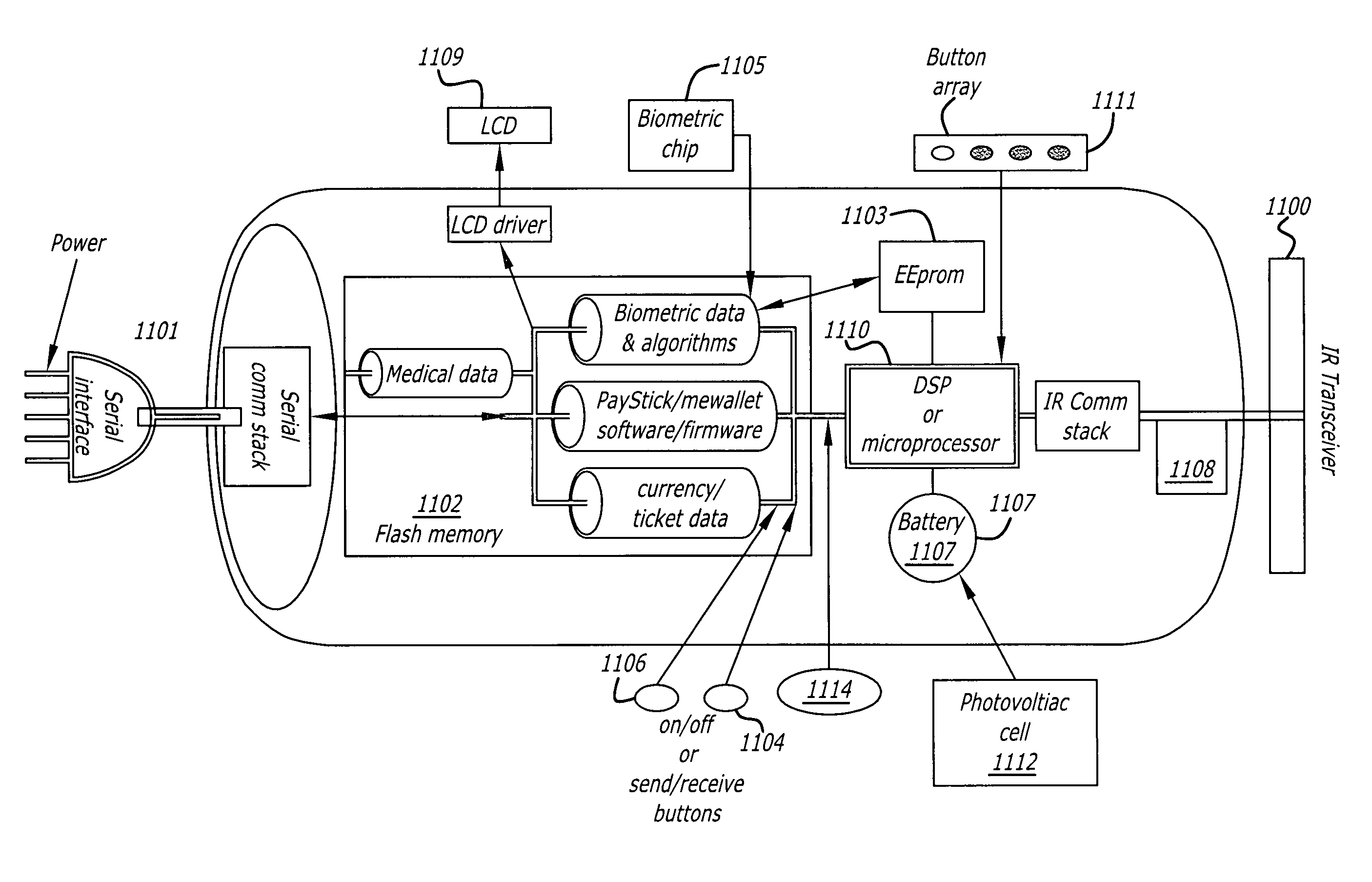

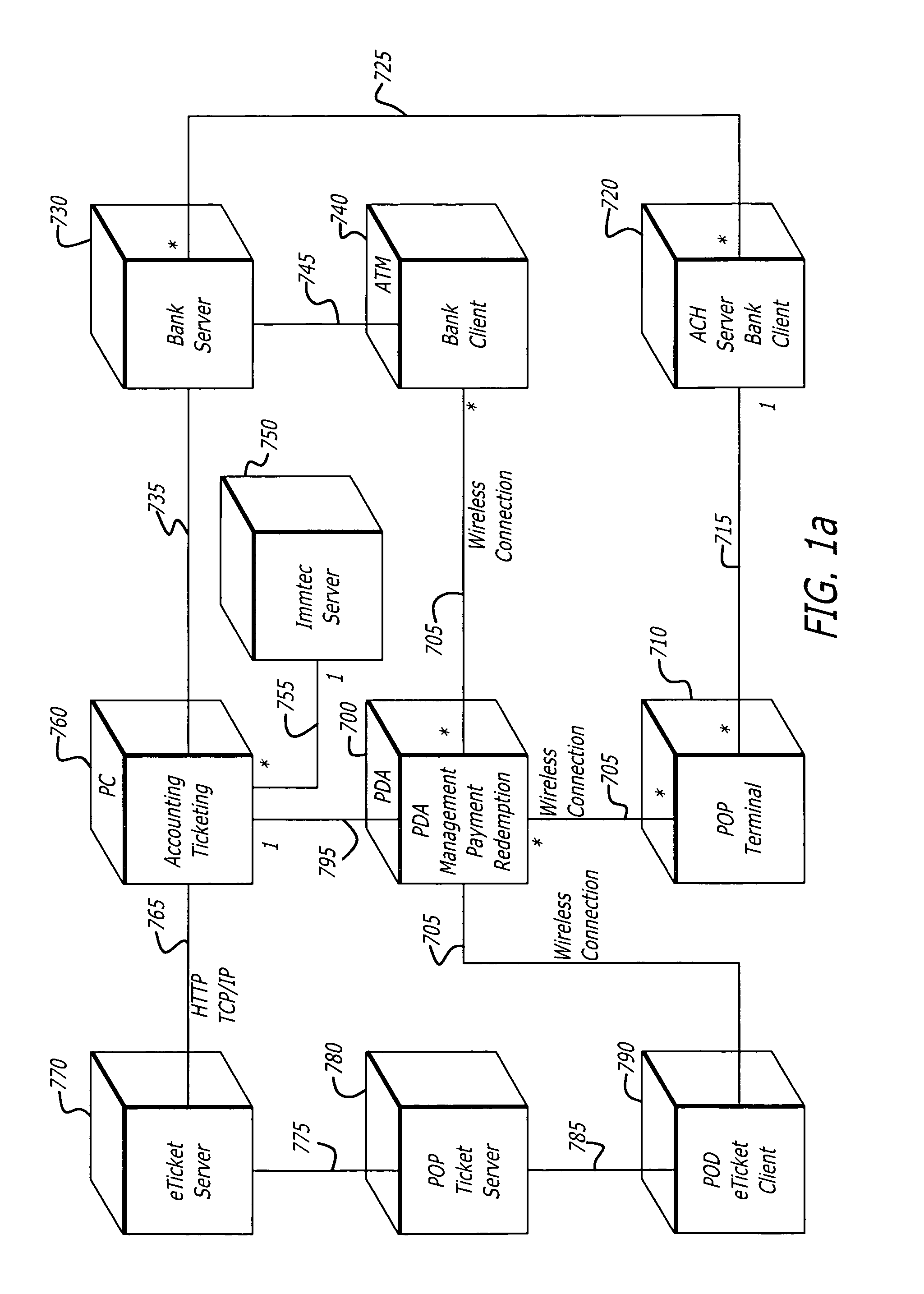

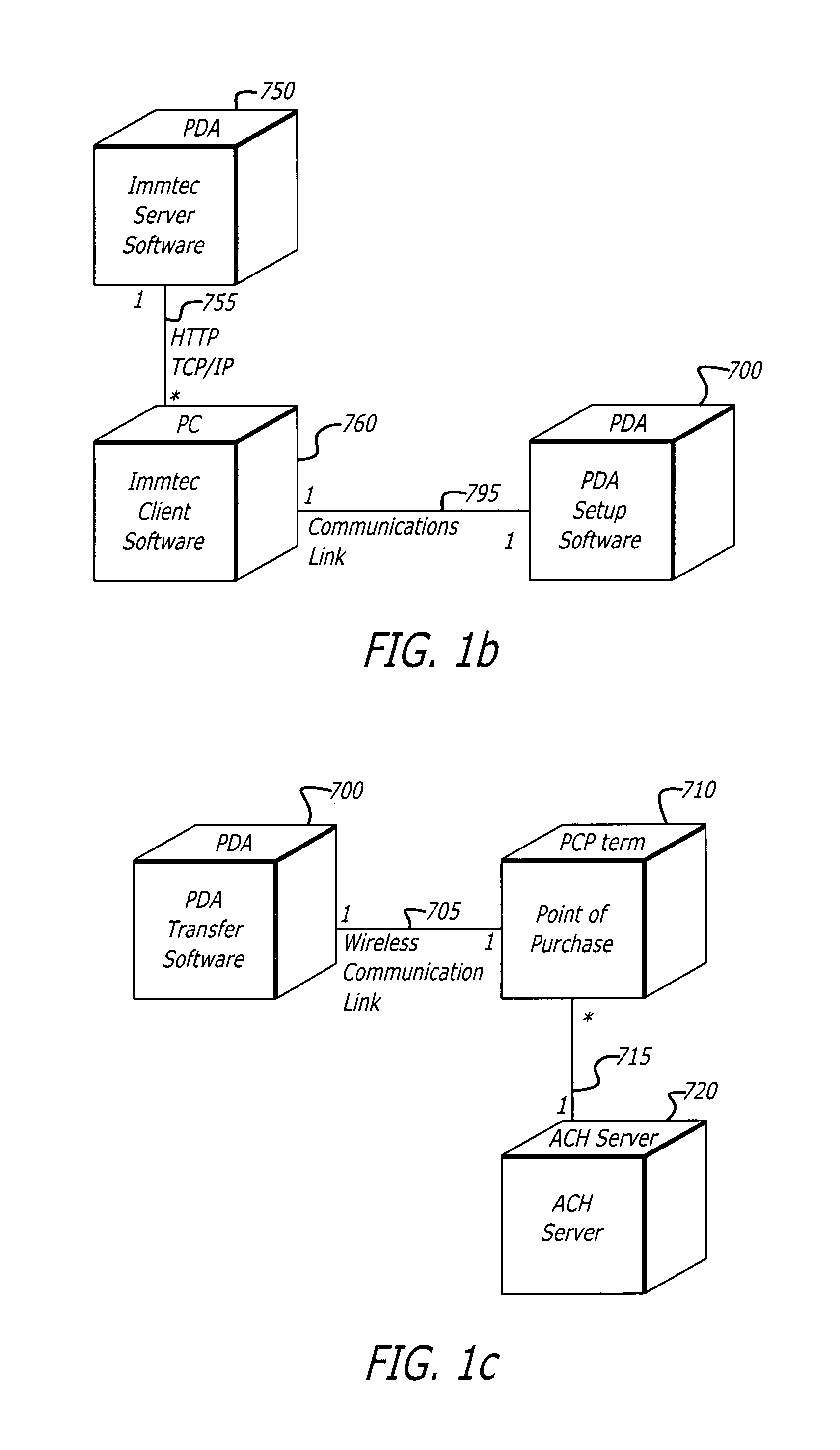

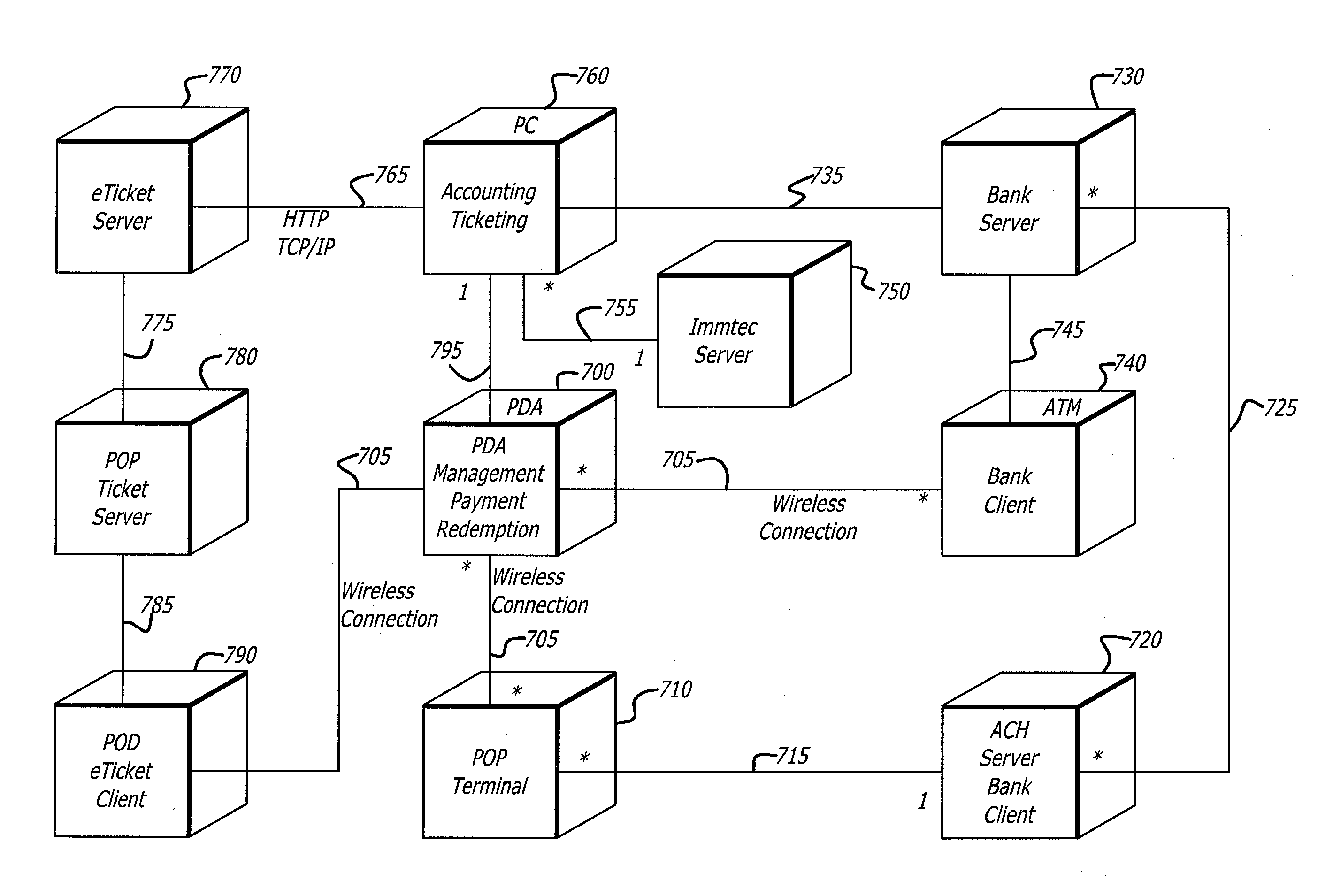

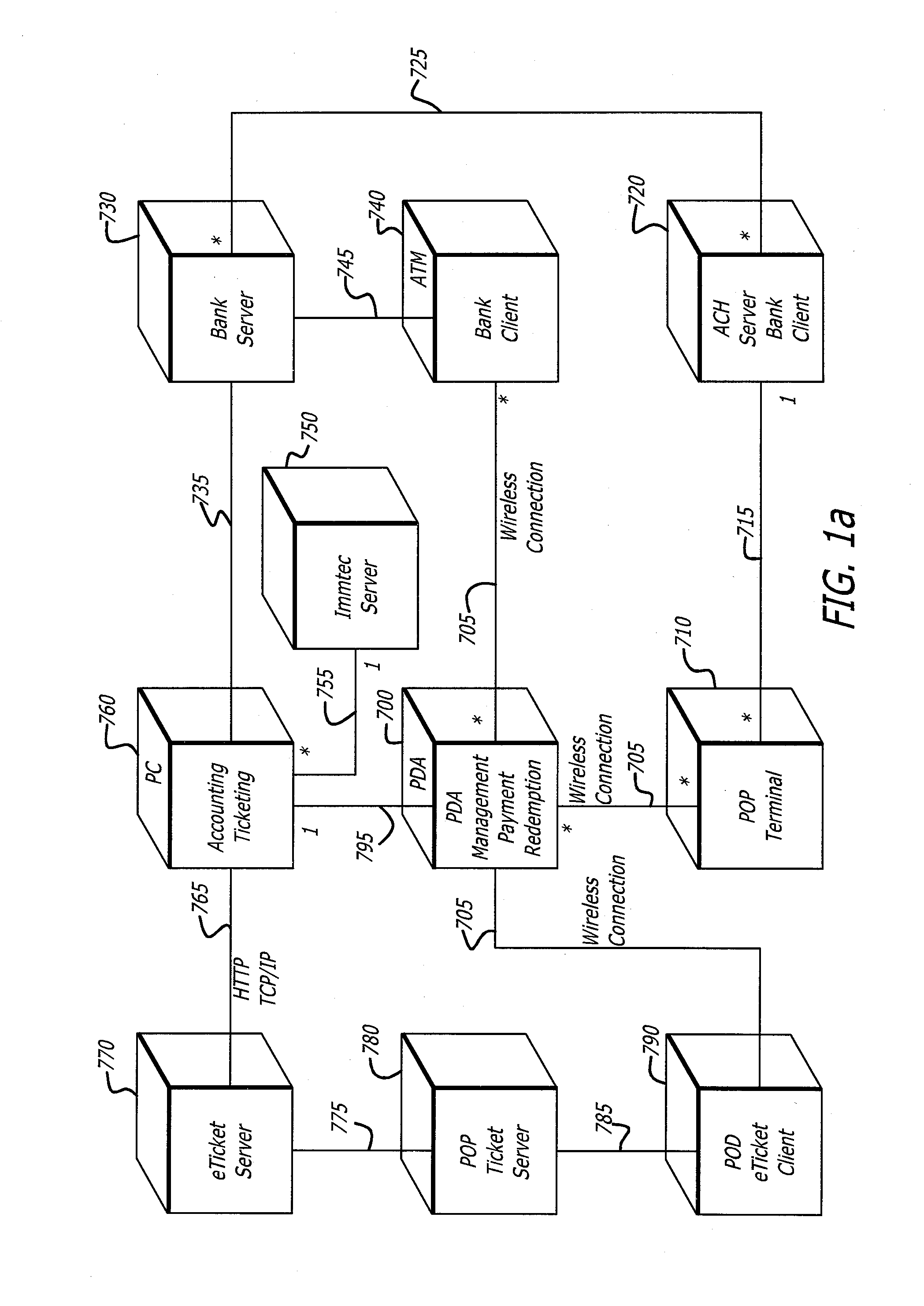

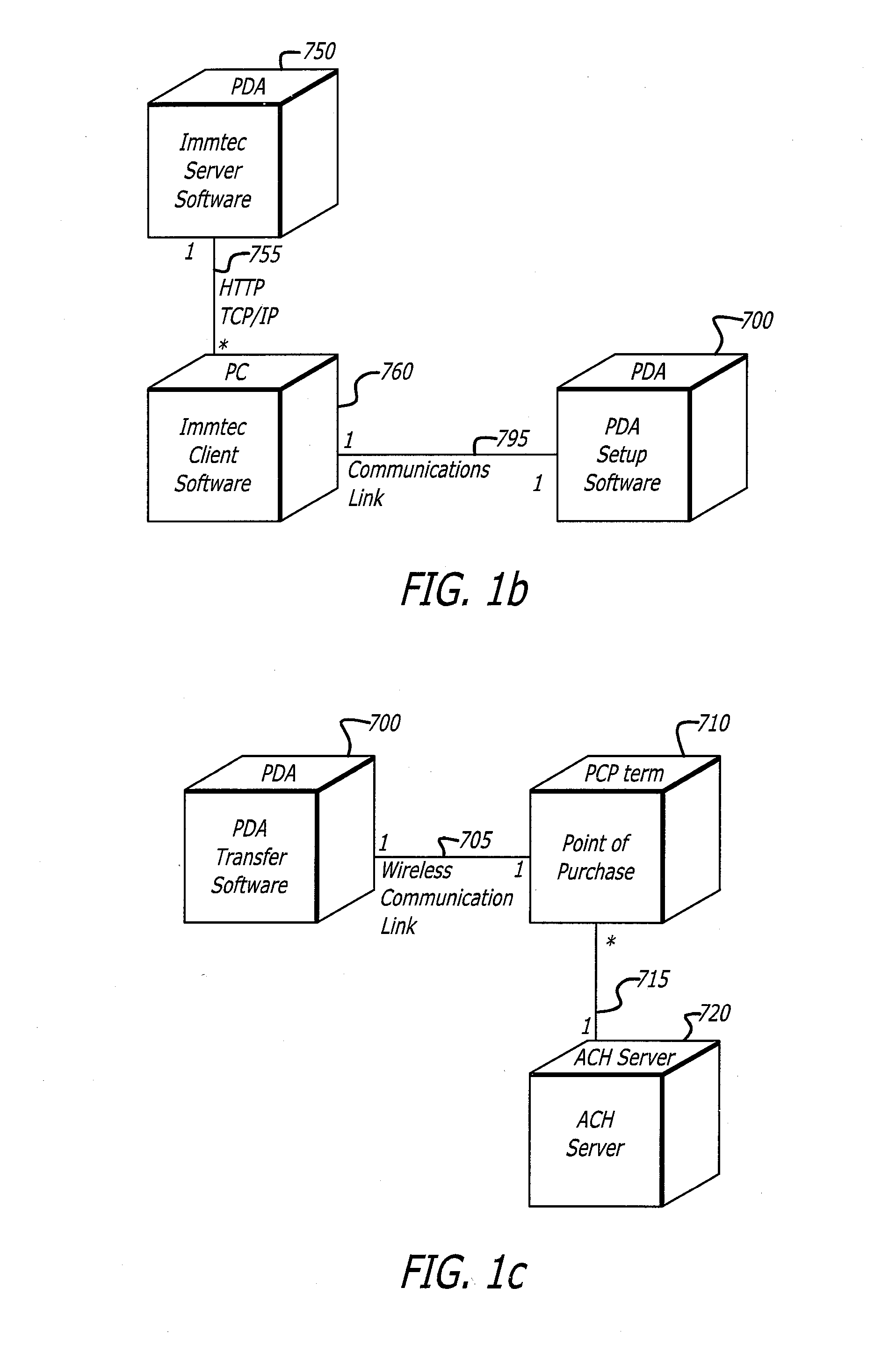

Apparatus, systems and methods for wirelessly transacting financial transfers , electronically recordable authorization transfers, and other information transfers

The present invention provides apparatus, systems and methods to wirelessly pay for purchases, electronically interface with financial accounting systems, and electronically record and wirelessly communicate authorization transactions using Personal Digital Assistant (“PDA”)(also referred to as Personal Intelligent Communicators (PICs), and Personal Communicators), palm computers, intelligent handheld cellular and other wireless telephones, and other personal handheld electronic devices configured with infrared or other short range data communications (for referential simplicity, such devices are referred to herein as “PDA's”). The present invention further provides apparatus, firmware, software programs and computer-implemented methods for making service and / or sale service charge payments for credit card charges, debit card charges, electronic cash transfers, ticket and other like financial transactions and for other types of transactions, such as for electronic coupons, where the amount of the transaction is for a small amount of money, such as, for example, less than $5.00.

Owner:SENTEGRA

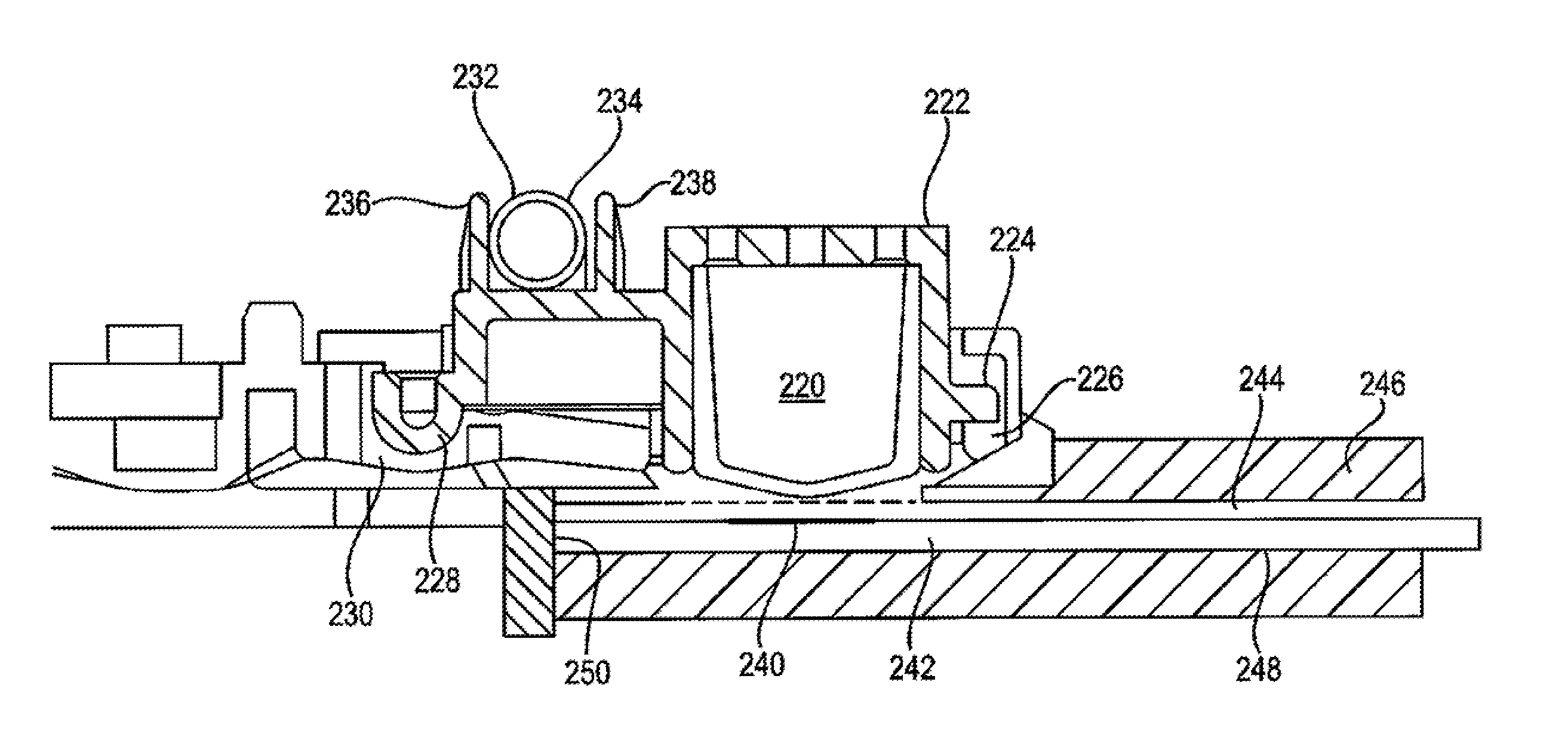

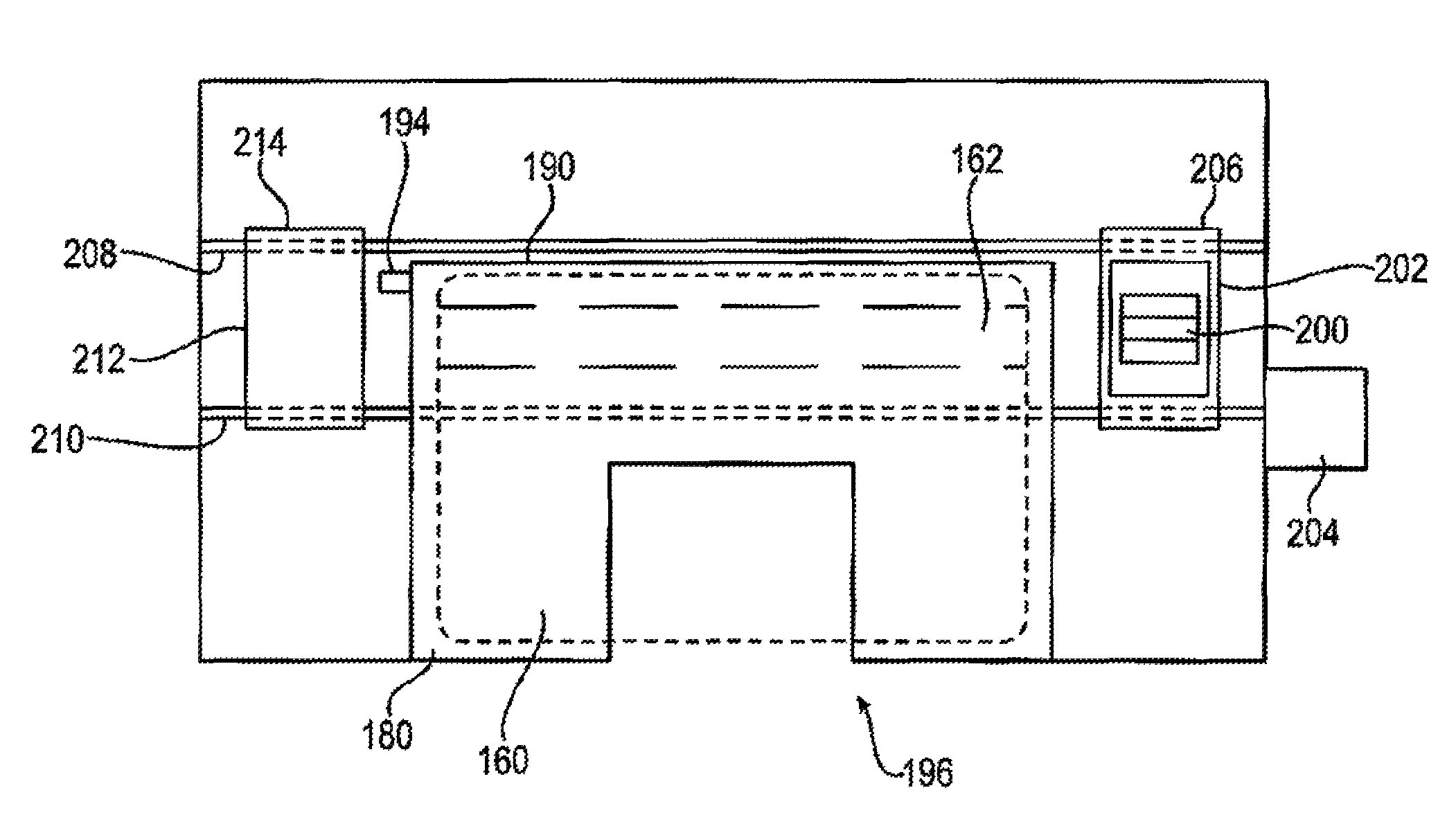

Banking machine controlled responisve to data read from data bearing records

ActiveUS20140217169A1Function increaseEasy to installComplete banking machinesFinanceMachine controlFinancial transfer

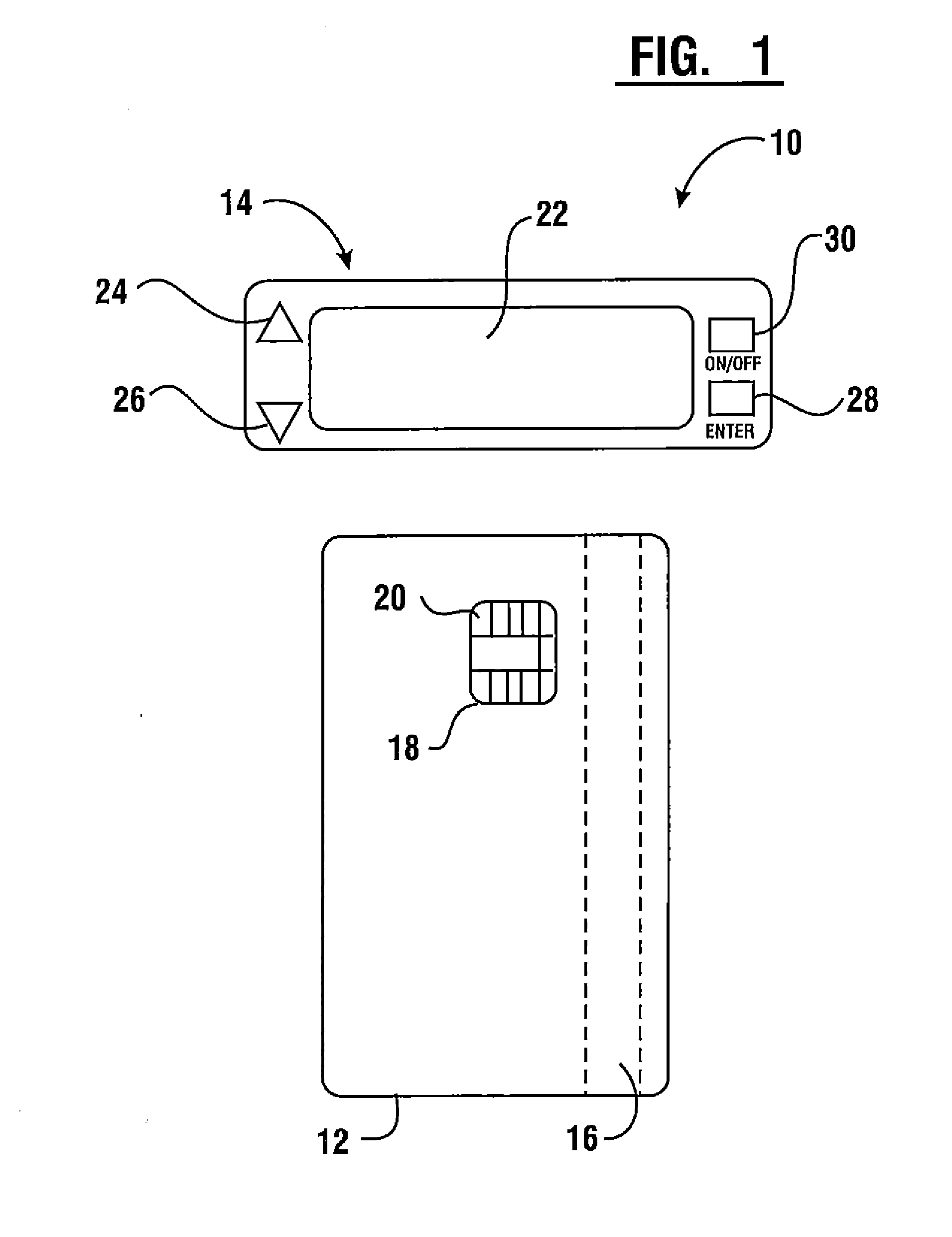

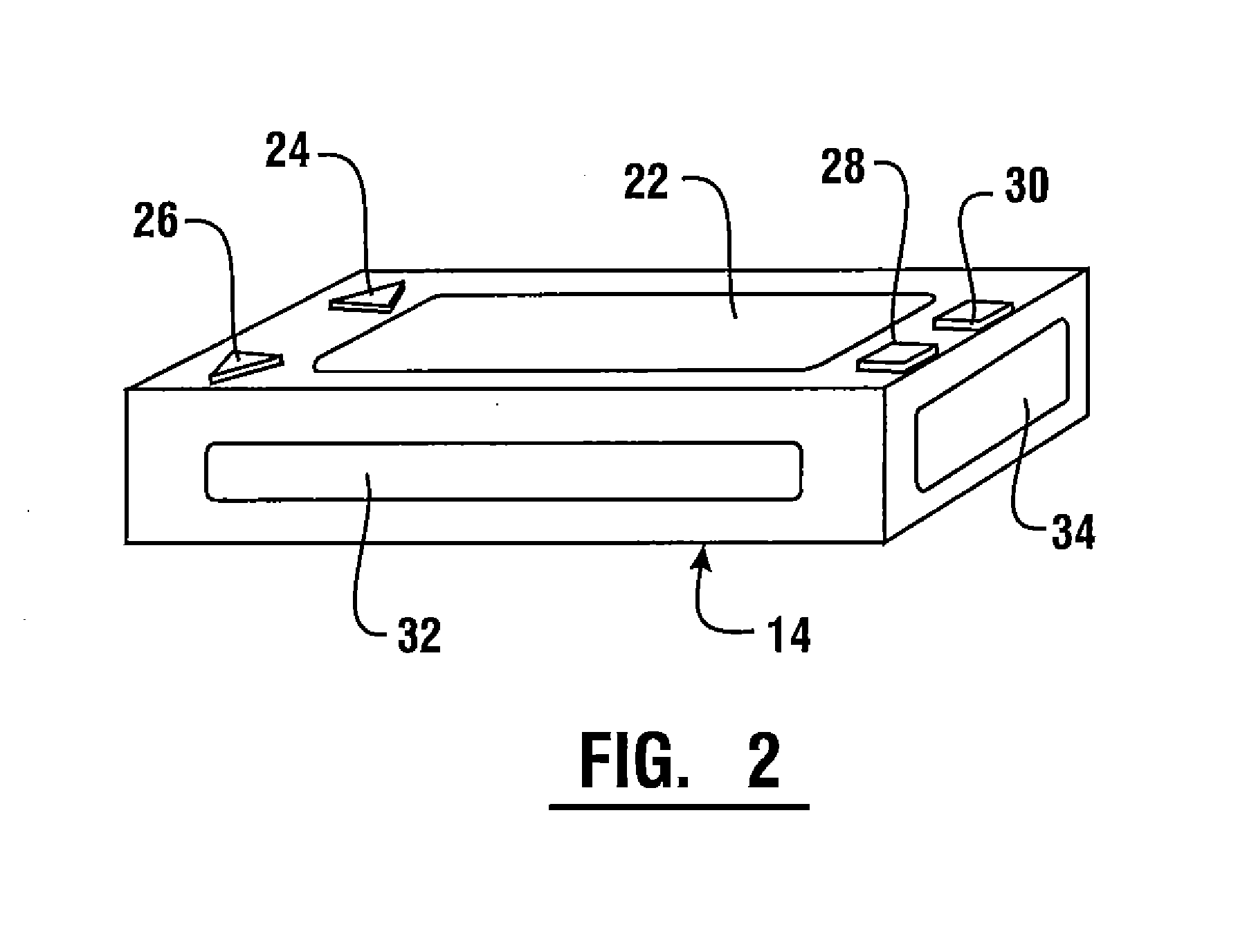

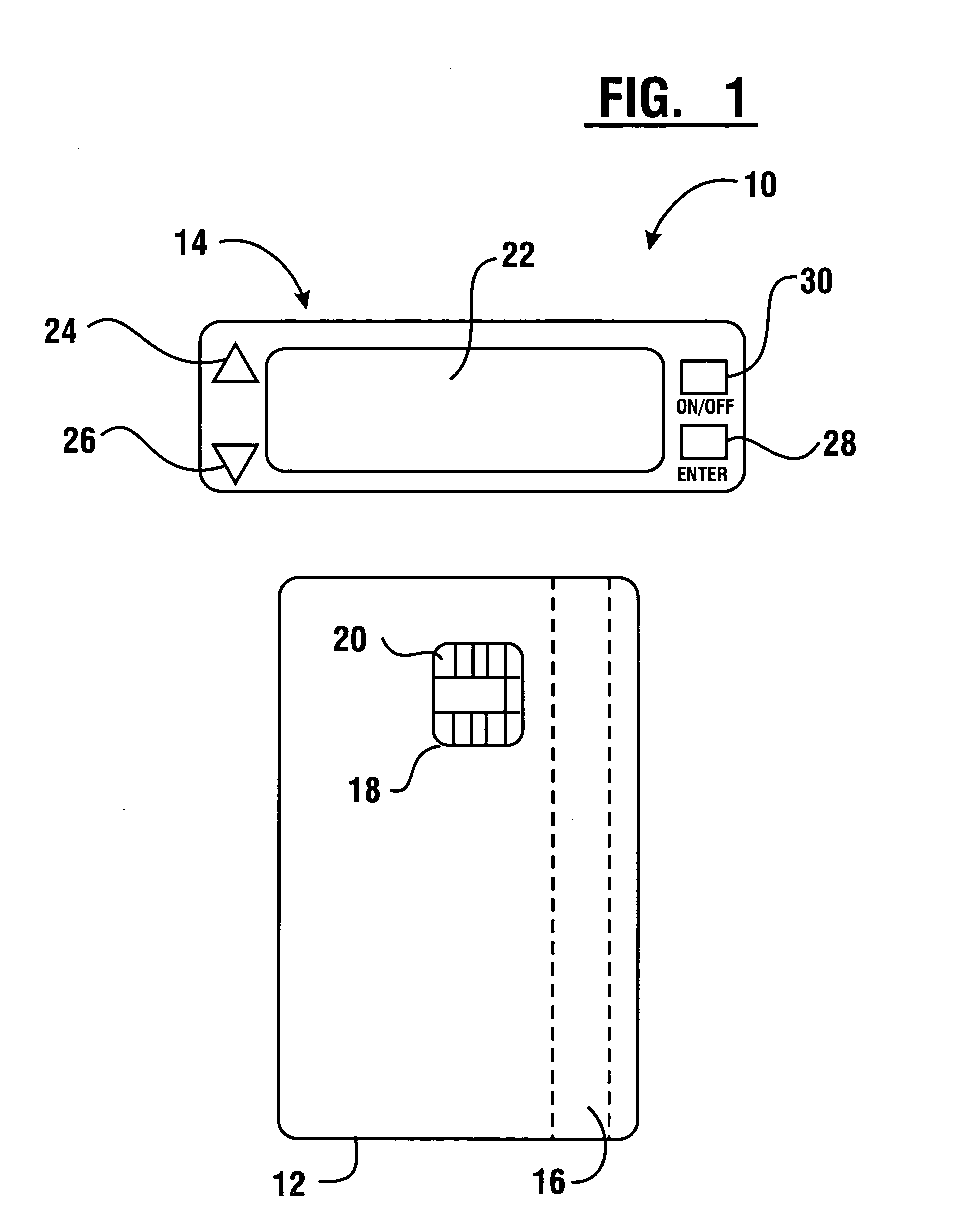

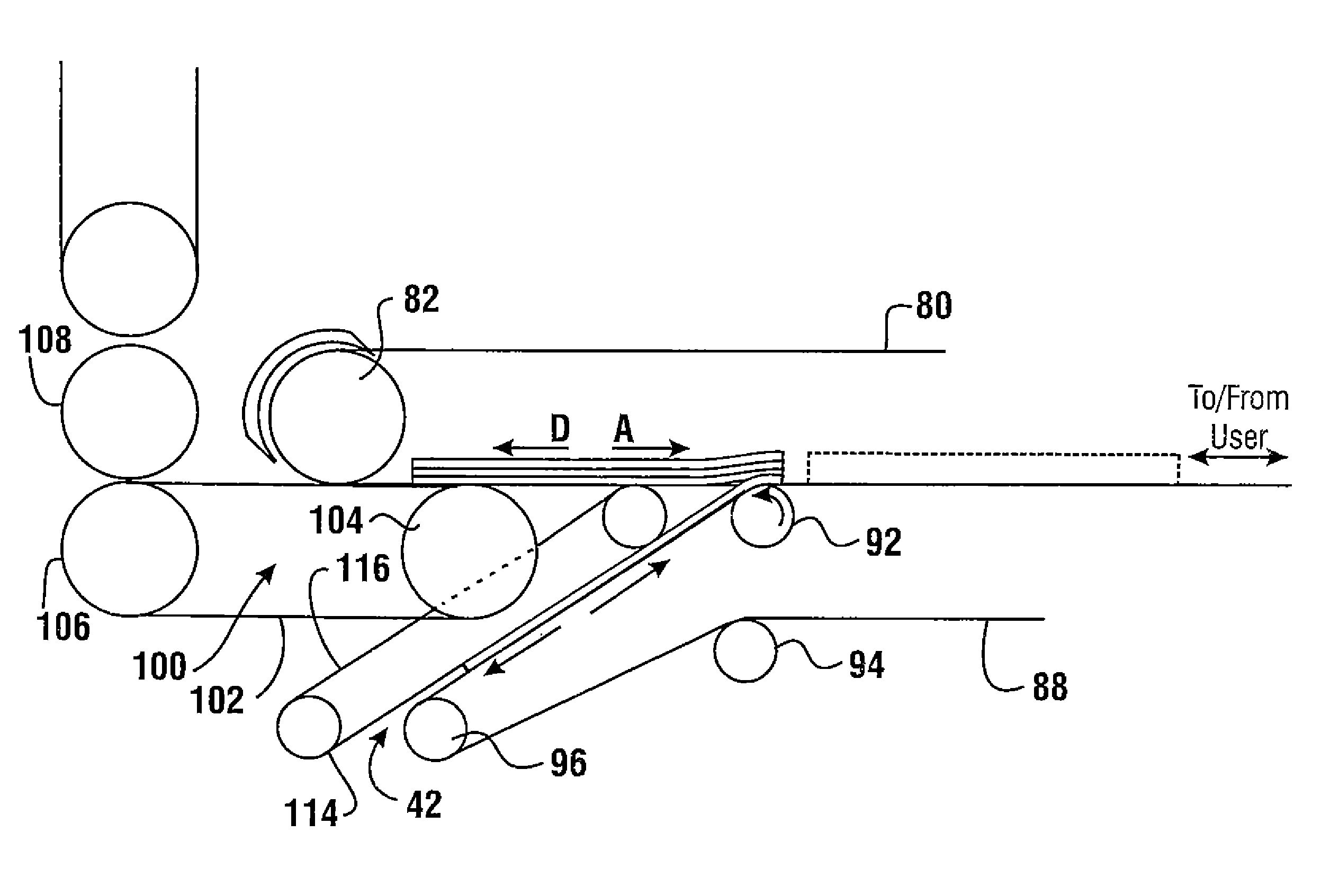

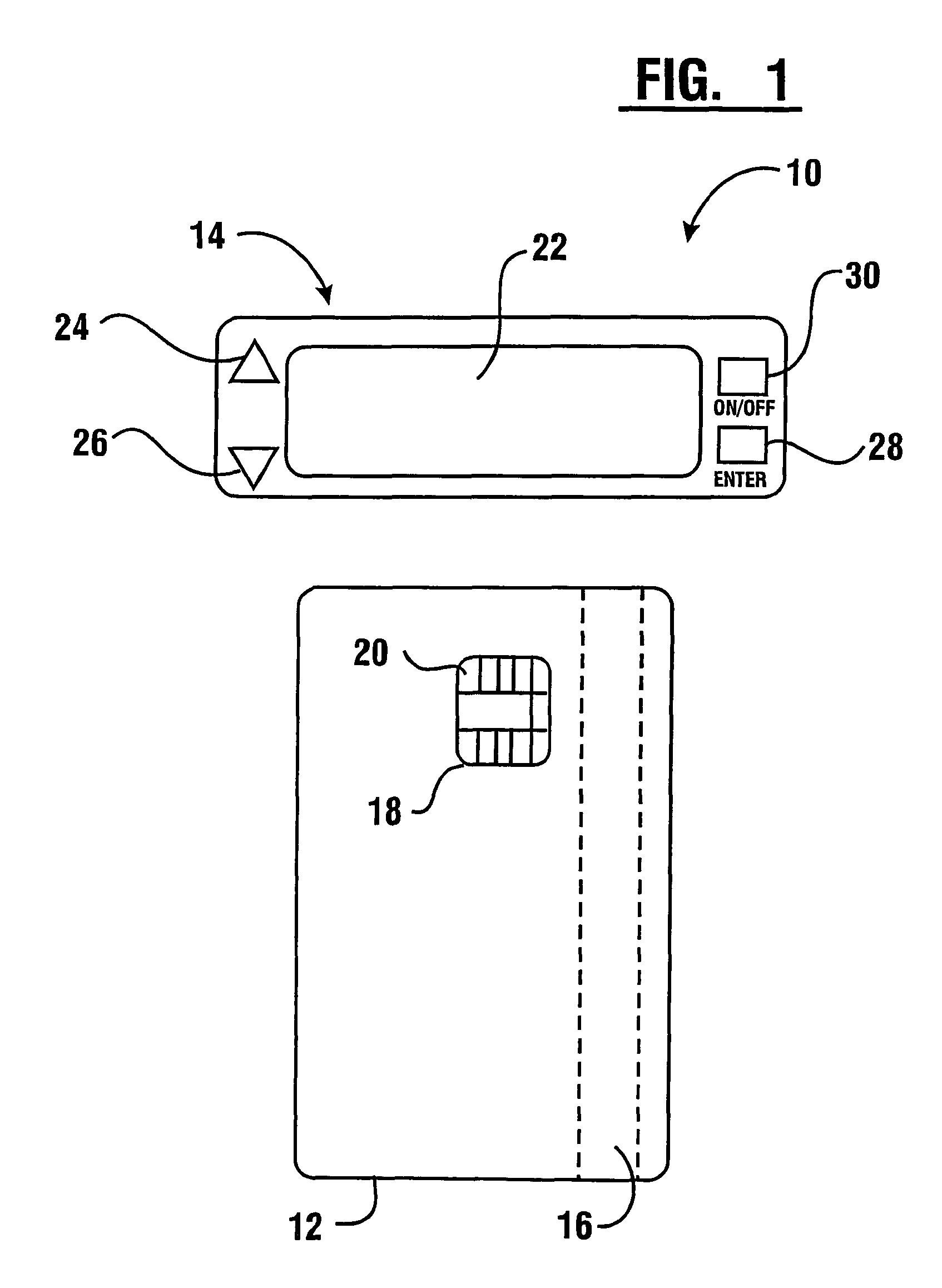

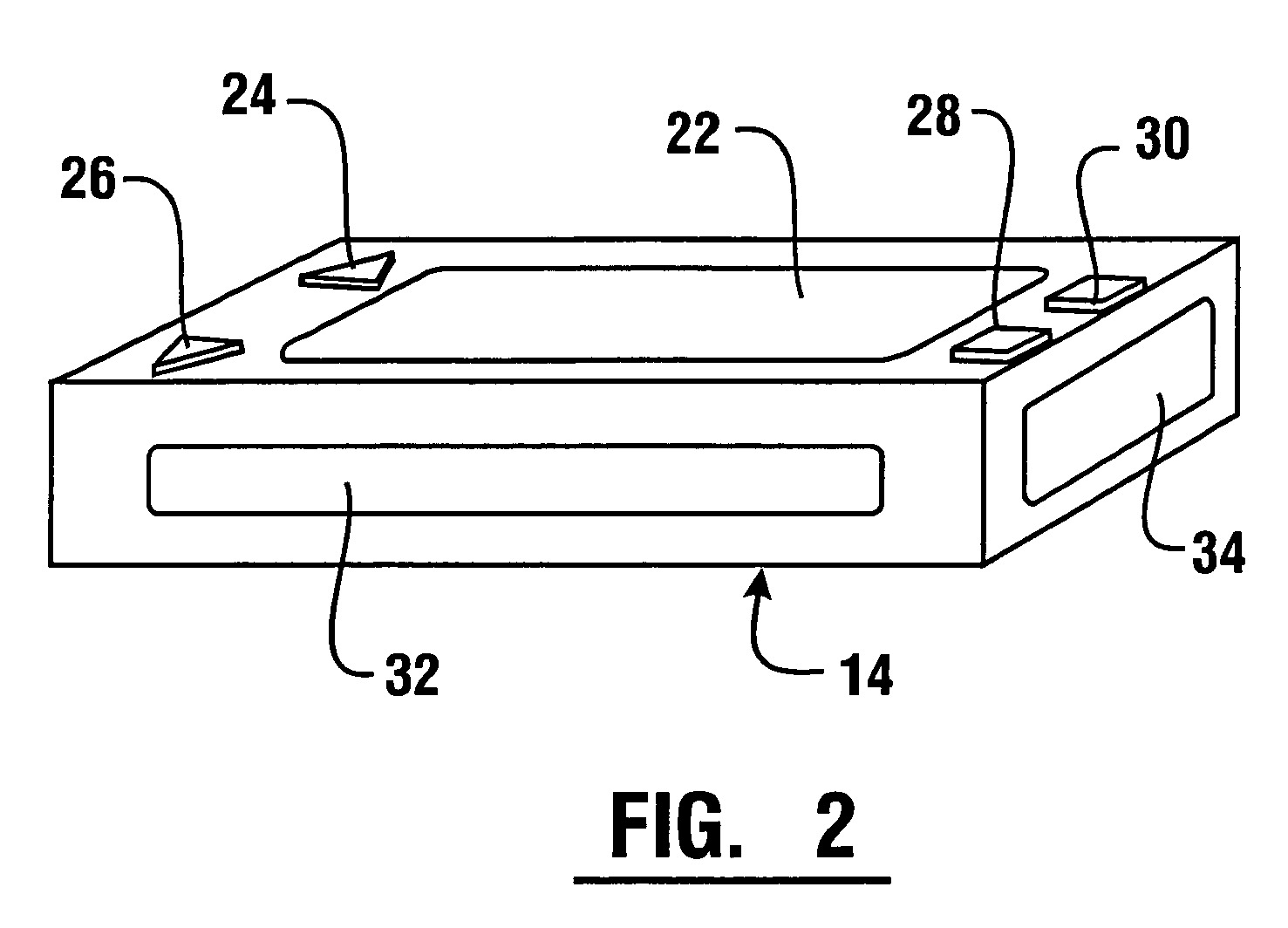

A banking system operates responsive to data read from data bearing records. The system includes an automated banking machine comprising a card reader. The card reader includes a movable read head that can read card data along a magnetic stripe of a card that was inserted long-edge first. The card reader includes a card entry gate. The gate is opened for a card that is determined to be properly oriented for data reading. The card reader can encrypt card data, including account data. The card data is usable by the machine to authorize a user to carry out a financial transfer involving the account.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

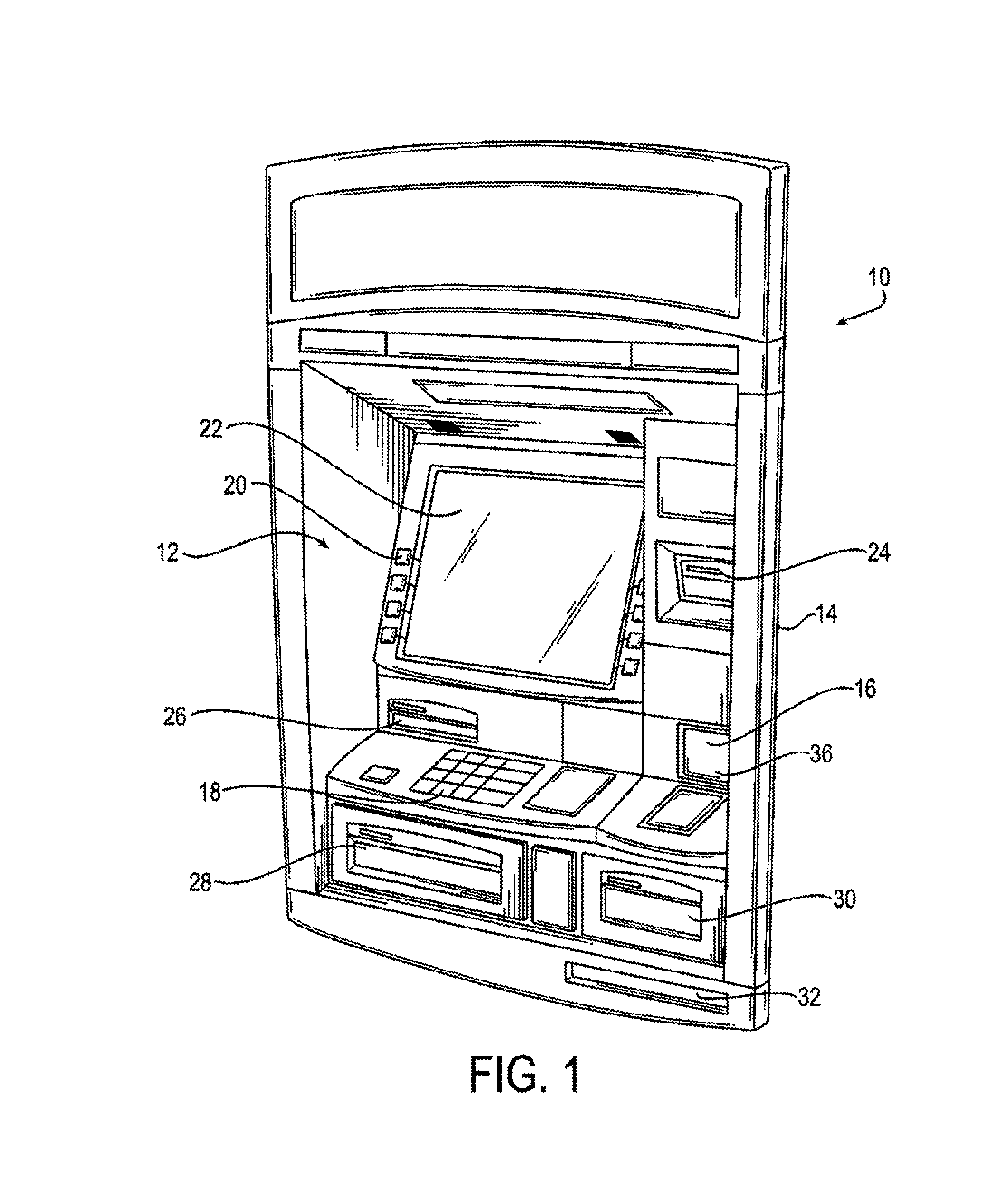

Automated teller machine with an encrypting card reader and an encrypting pin pad

ActiveUS20140081874A1Function increaseEasy to installComplete banking machinesAcutation objectsEncrypting PIN PadFinancial transfer

A banking system operates responsive to data read from data bearing records. The system includes an automated banking machine comprising a card reader. The card reader includes a movable read head that can read card data along a magnetic stripe of a card that was inserted long-edge first. The card reader includes a card entry gate. The gate is opened for a card that is determined to be properly oriented for data reading. The card reader can encrypt card data, including account data. The machine also includes a PIN keypad. The card reader can send encrypted card data to the keypad. The keypad can decipher the encrypted card data. The keypad can encrypt both deciphered card data and a received user PIN. The card data and the PIN are usable by the machine to authorize a user to carry out a financial transfer involving the account.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

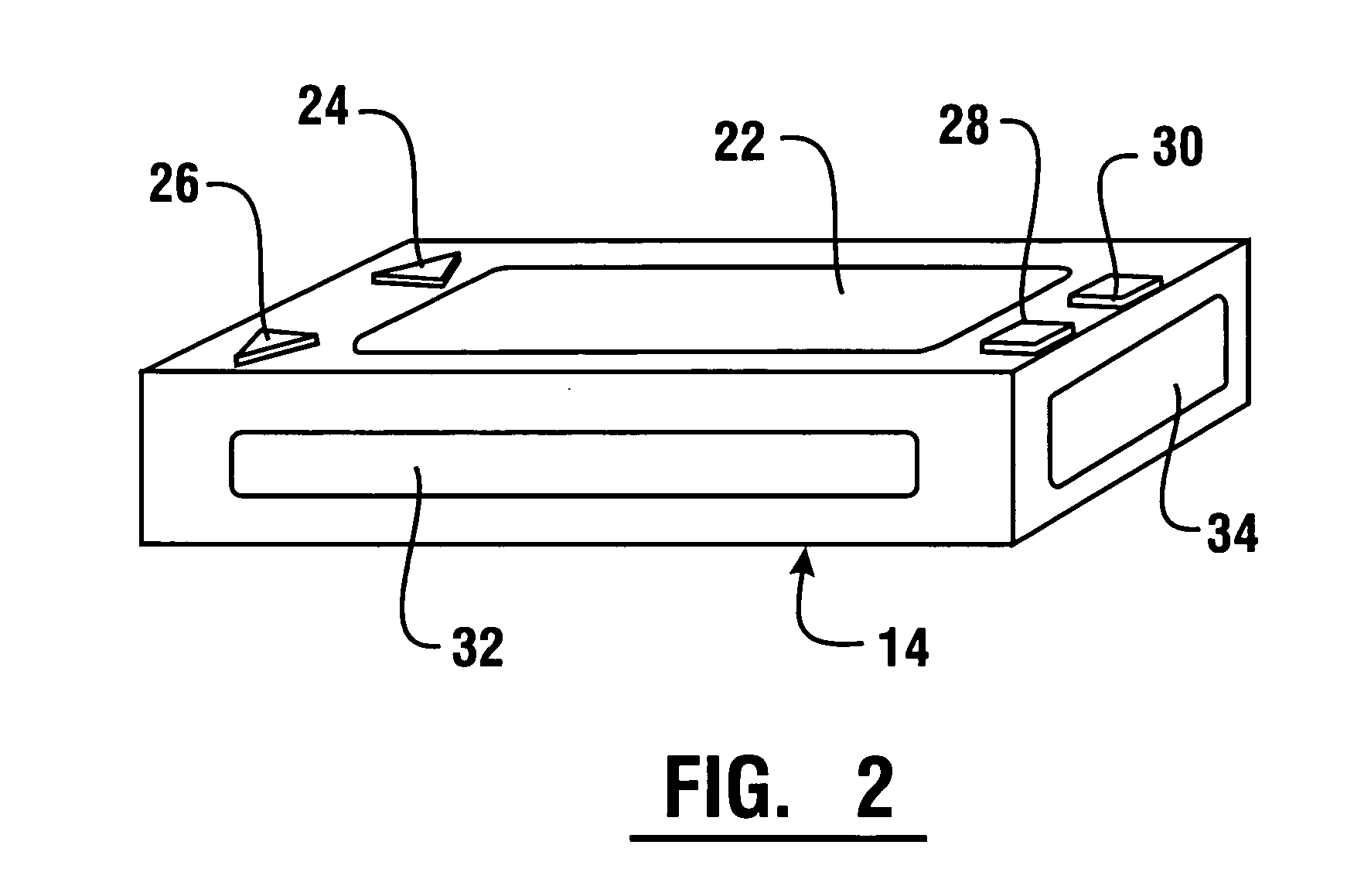

Banking Terminal that Operates to Cause Financial Transfers Responsive to Data Bearing Records

InactiveUS20120074217A1Risk minimizationLow production costComplete banking machinesFinanceComputer terminalRemote computer

A portable terminal operates to cause financial transfers responsive to data read from data bearing records in the form of user cards. The user cards include credit and / or debit cards. Data corresponding to the card data is stored in at least one memory of the terminal. The terminal includes a wireless communication device. The terminal operates to wirelessly communicate data corresponding to card data to one or more remote computers to cause financial transfers to or from selected accounts. The terminal also operates to provide outputs corresponding to account balances and to receive data corresponding to receipts.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

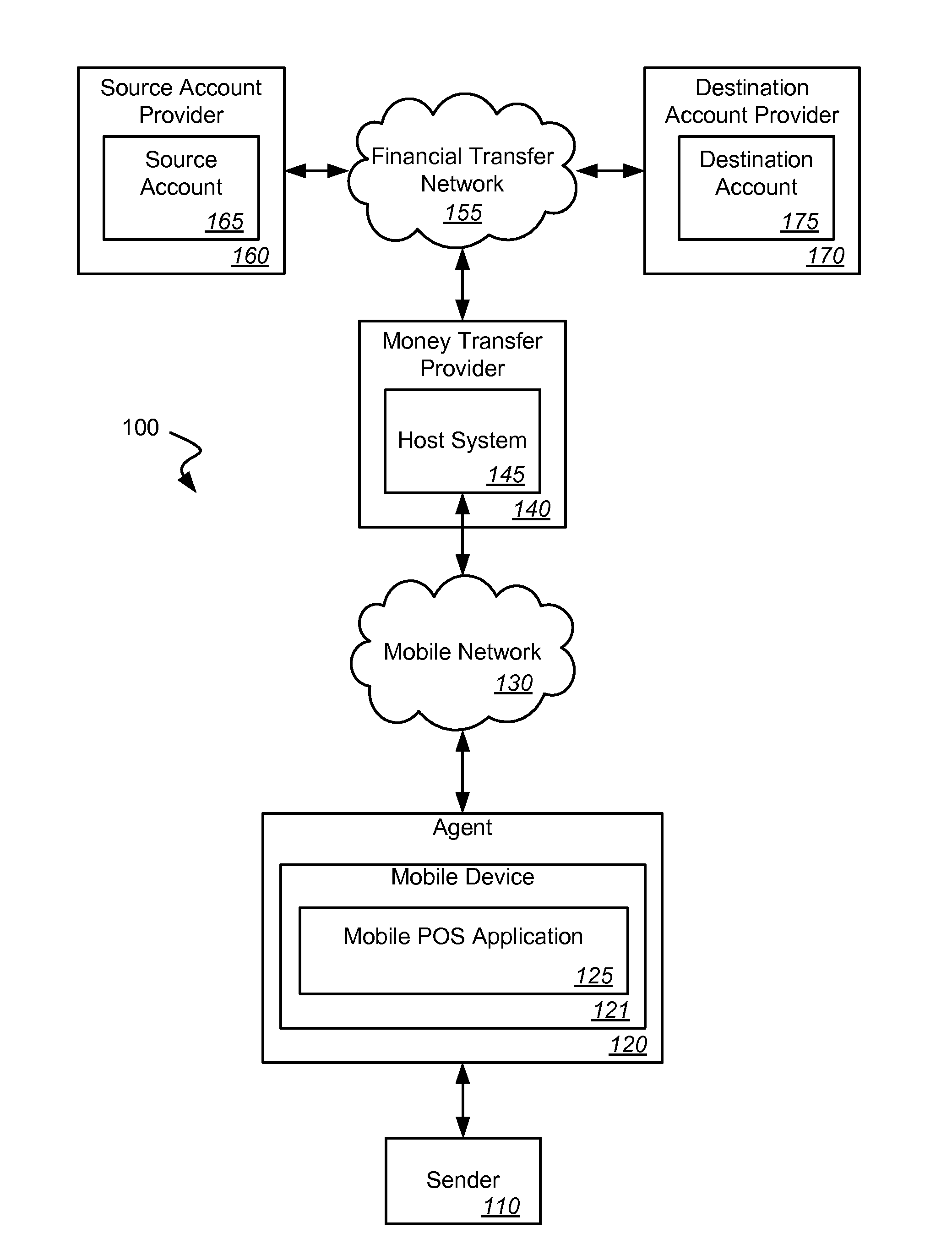

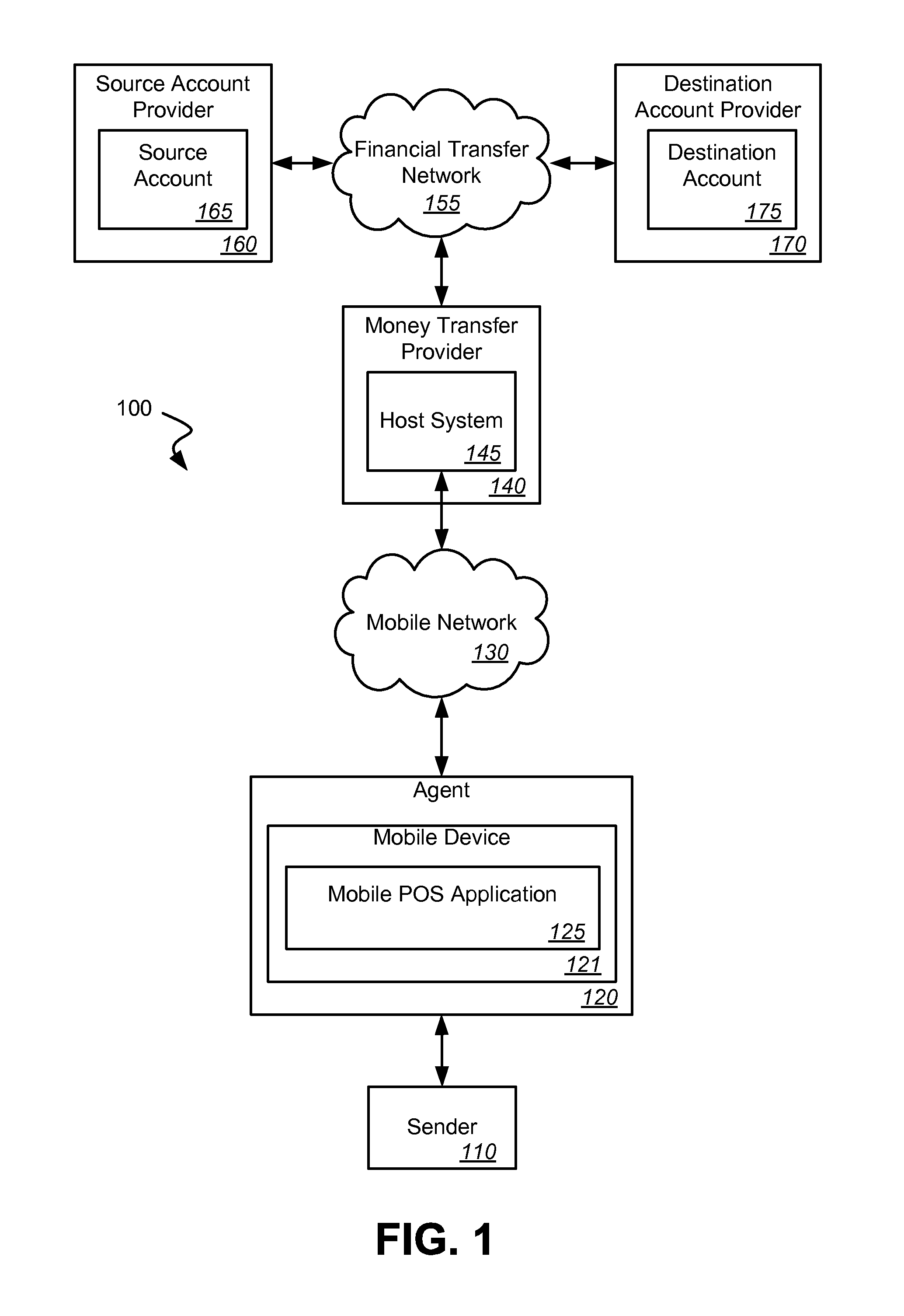

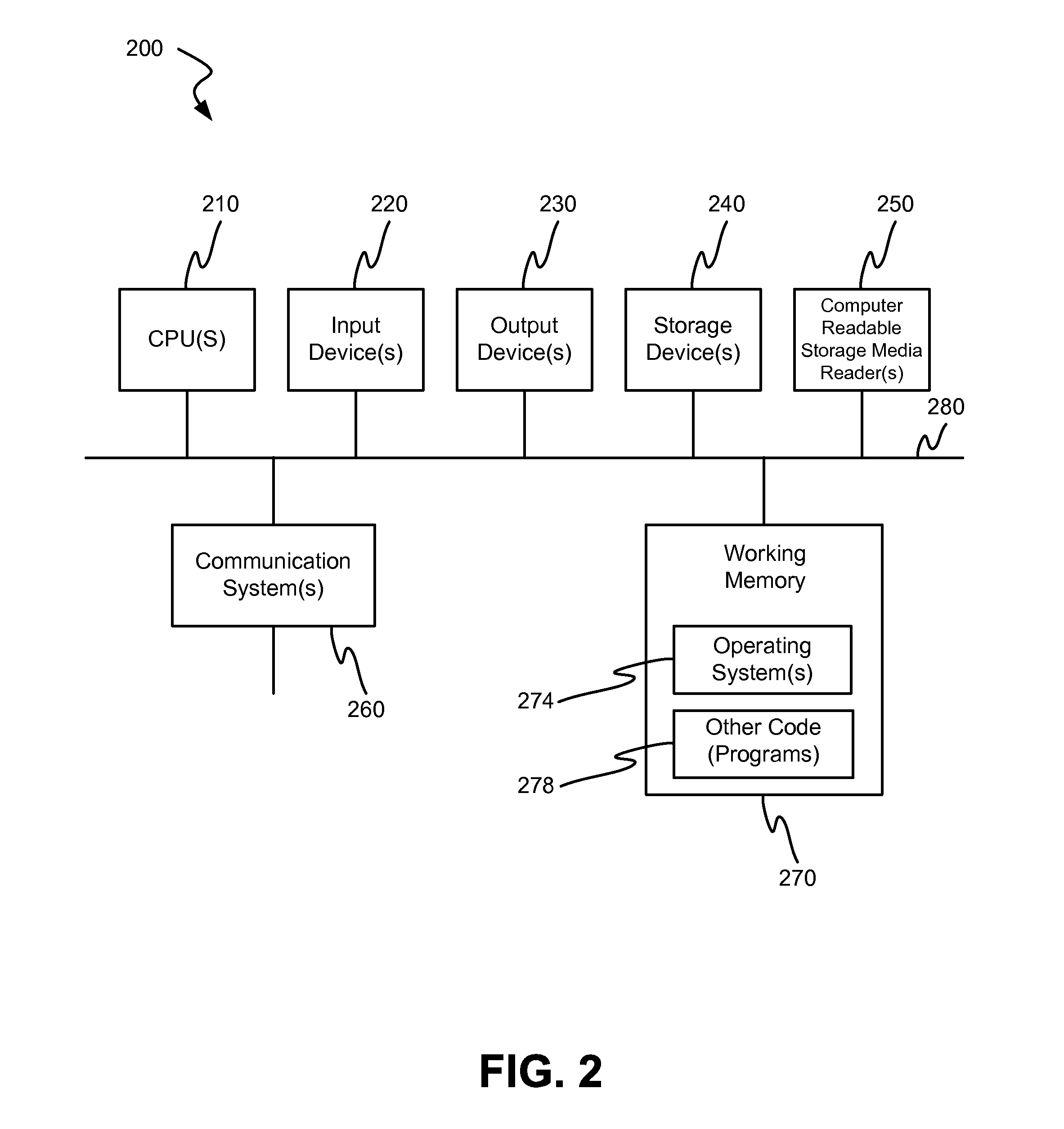

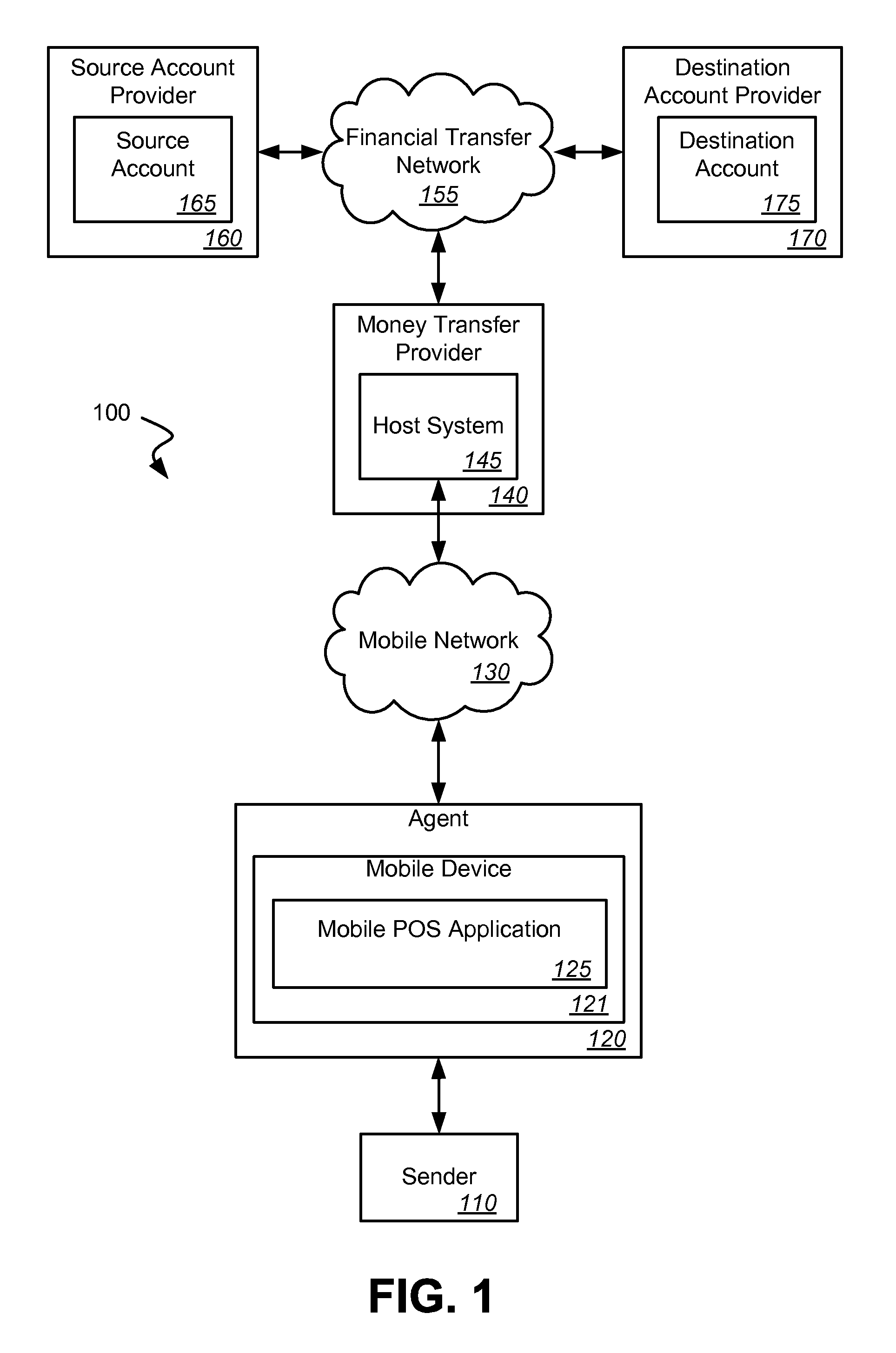

Mobile agent point-of-sale (POS)

InactiveUS20110251906A1FinancePoint-of-sale network systemsFinancial transactionApplication software

Systems and methods are disclosed for conducting transactions and financial transfers utilizing a mobile device communicatively coupled with a mobile communications network and executing a mobile point-of-sale application. According to some embodiments, the mobile point-of-sale application is adapted to conduct money transfer transactions by communicating transaction information through the mobile communications network to a money transfer provider system that processes the money transfer and communicates receipt information to the mobile point-of-sale application. Additionally, according to some embodiments, an account associated with an agent of the money transfer provider can be used in money transfer transactions conducted by the mobile point-of-sale application.

Owner:THE WESTERN UNION CO

Consumer-directed financial transfers using automated clearinghouse networks

InactiveUS7720760B1Quickly and efficiently transfer fundReadily availableComplete banking machinesOther printing matterFinancial transferComputer security

Owner:INTUIT INC

Automated banking machine that operates responsive to data read from data bearing records

ActiveUS20100012718A1Expand accessHigh outputComplete banking machinesFinanceCard readerFinancial transfer

An automated banking machine operates responsive to data read from data bearing records to cause financial transfers. The machine includes a card reader that operates to read card data from user cards. The card data corresponds to financial accounts. The automated banking machine includes a cash dispenser and the machine carries out transaction functions for consumers including dispensing cash. Responsive to a diagnostic article being in operative connection with the machine a servicer interface of the machine may selectively output textual indicia included in service manuals. Servicers may also selectively conduct diagnostic activities at a servicer interface and a consumer interface on the machine.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

Automated banking machine that can detect servicing actions

In an example embodiment, an automated banking machine can cause financial transfers responsive to data read from data bearing records. The machine includes a card reader that can read from user cards, card data which corresponds to financial accounts. The machine can operate responsive to the read card data to carry out transactions that transfer and / or allocate funds between accounts. The machine can provide users a transaction receipt. The machine includes a cash dispenser that can dispense cash to authorized users. Value of dispensed cash can be assessed to an account which corresponds to the read card data. The machine is equipped with sensing devices strategically positioned adjacent to machine components. The sensing devices enable the machine to automatically detect servicing activities performed on the machine. The machine is operable to send information corresponding to detected service activity to a service data-collecting computer.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

Automated Banking System Controlled Responsive to Data Bearing Records

ActiveUS20120138677A1Improved operating and servicingEnergy efficiencyComplete banking machinesFinanceCard readerElectric power

An automatic banking machine operates responsive to data read from data bearing records corresponding to authorized user or financial account data. The machine includes a card reader for reading data from user cards. The automated banking machine causes financial transfers related to financial accounts that correspond to data read from user cards. The automated banking machine also includes devices that control the supply of power to included devices to avoid exceeding power supply capacity.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

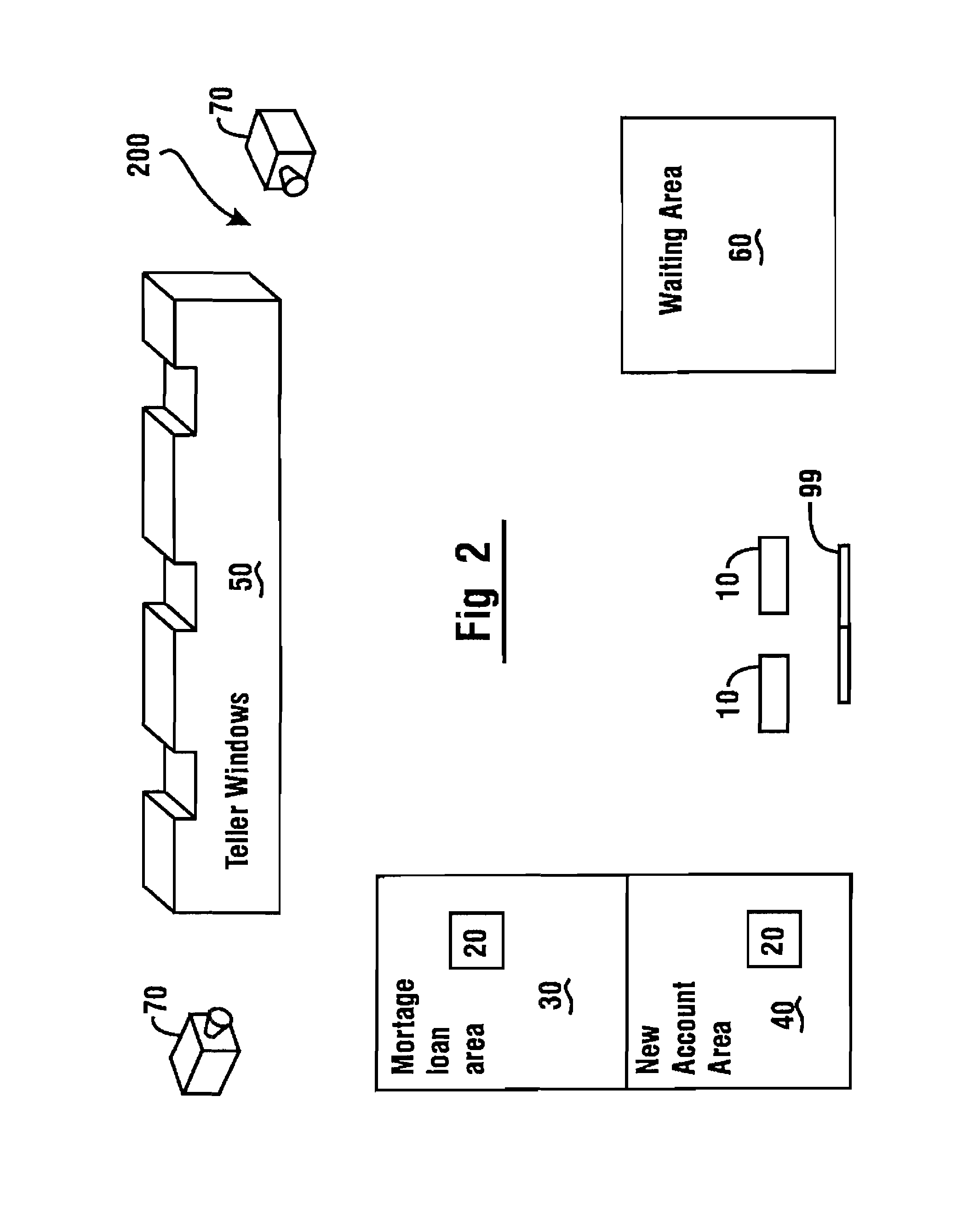

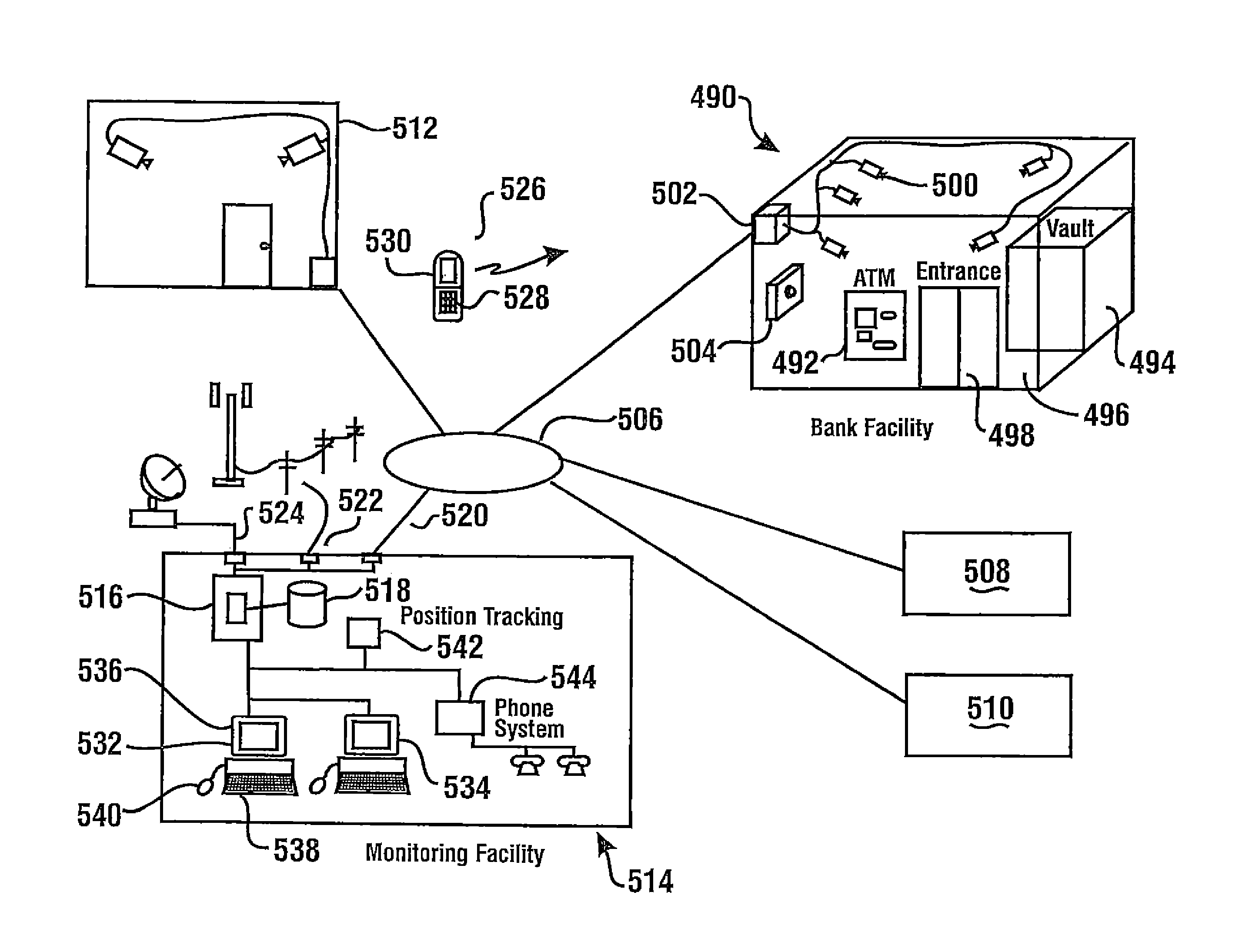

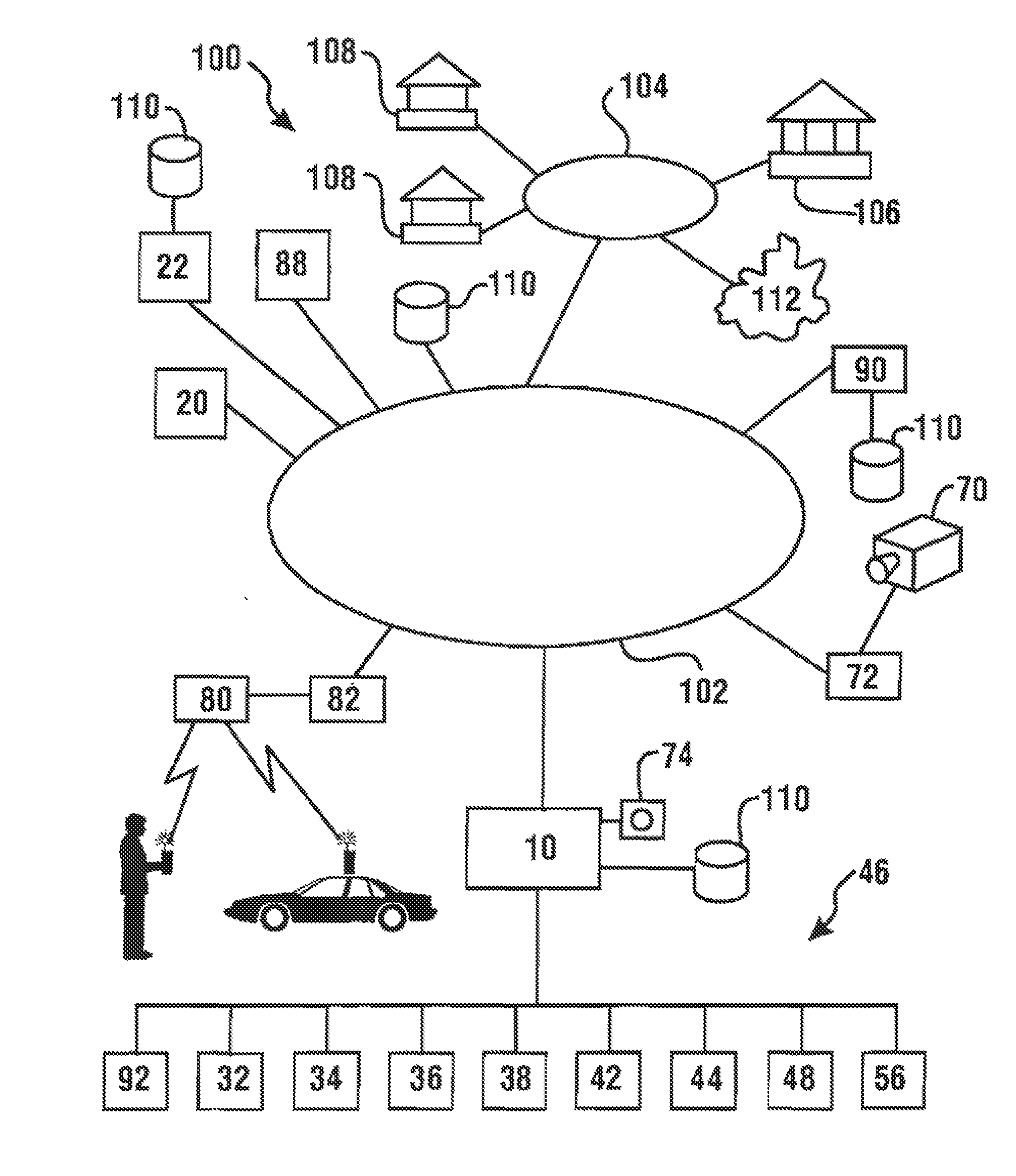

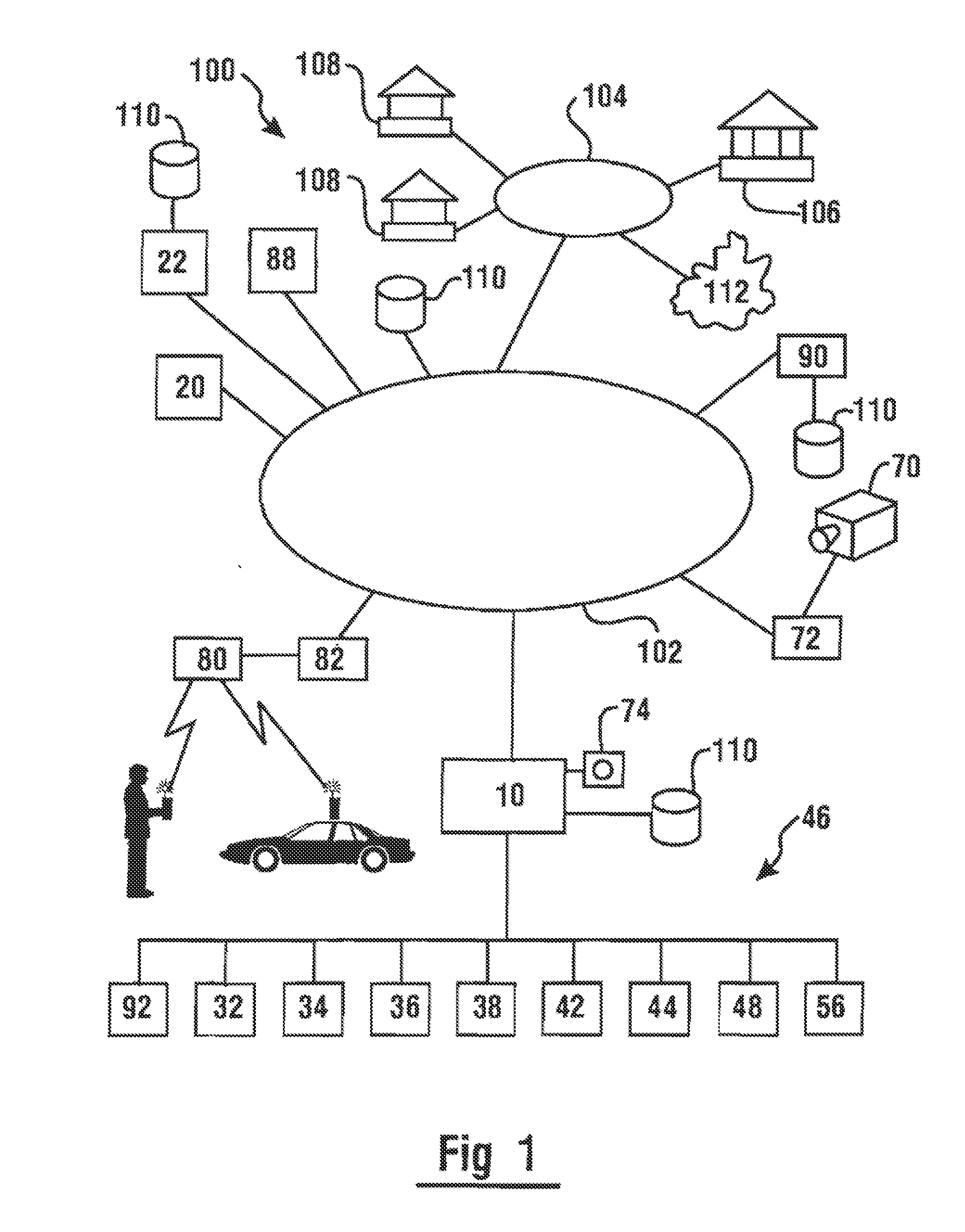

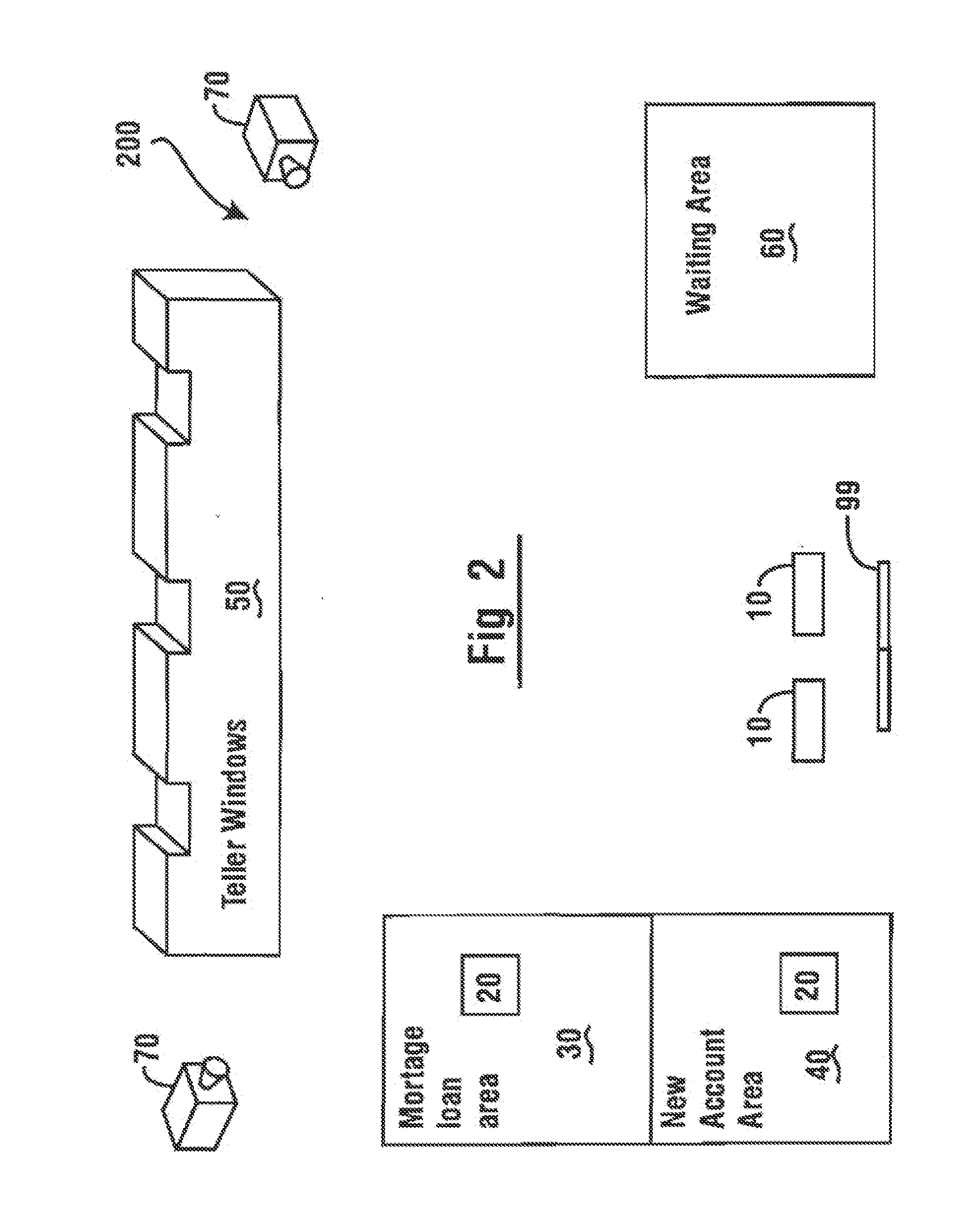

Automated banking machine and monitoring method

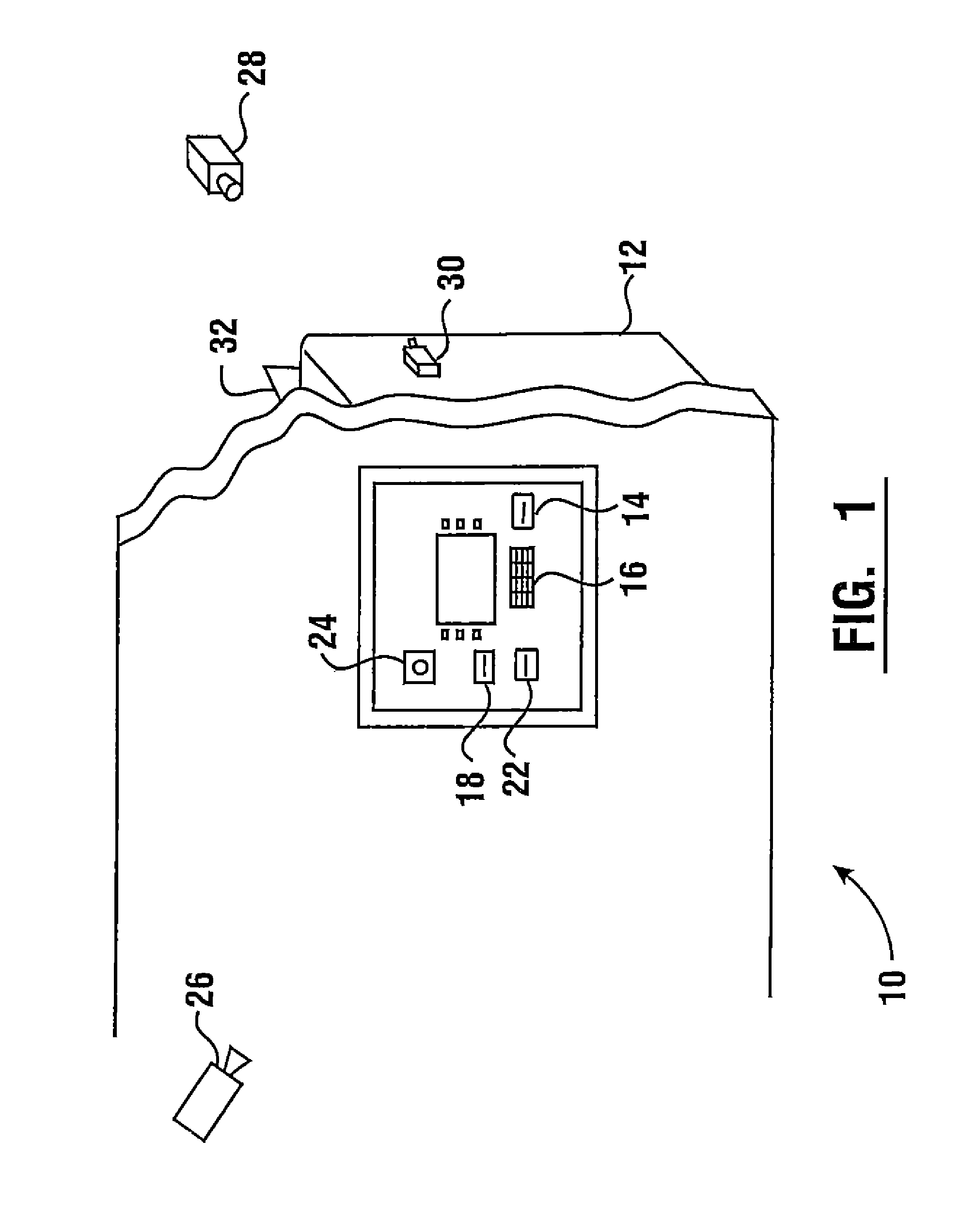

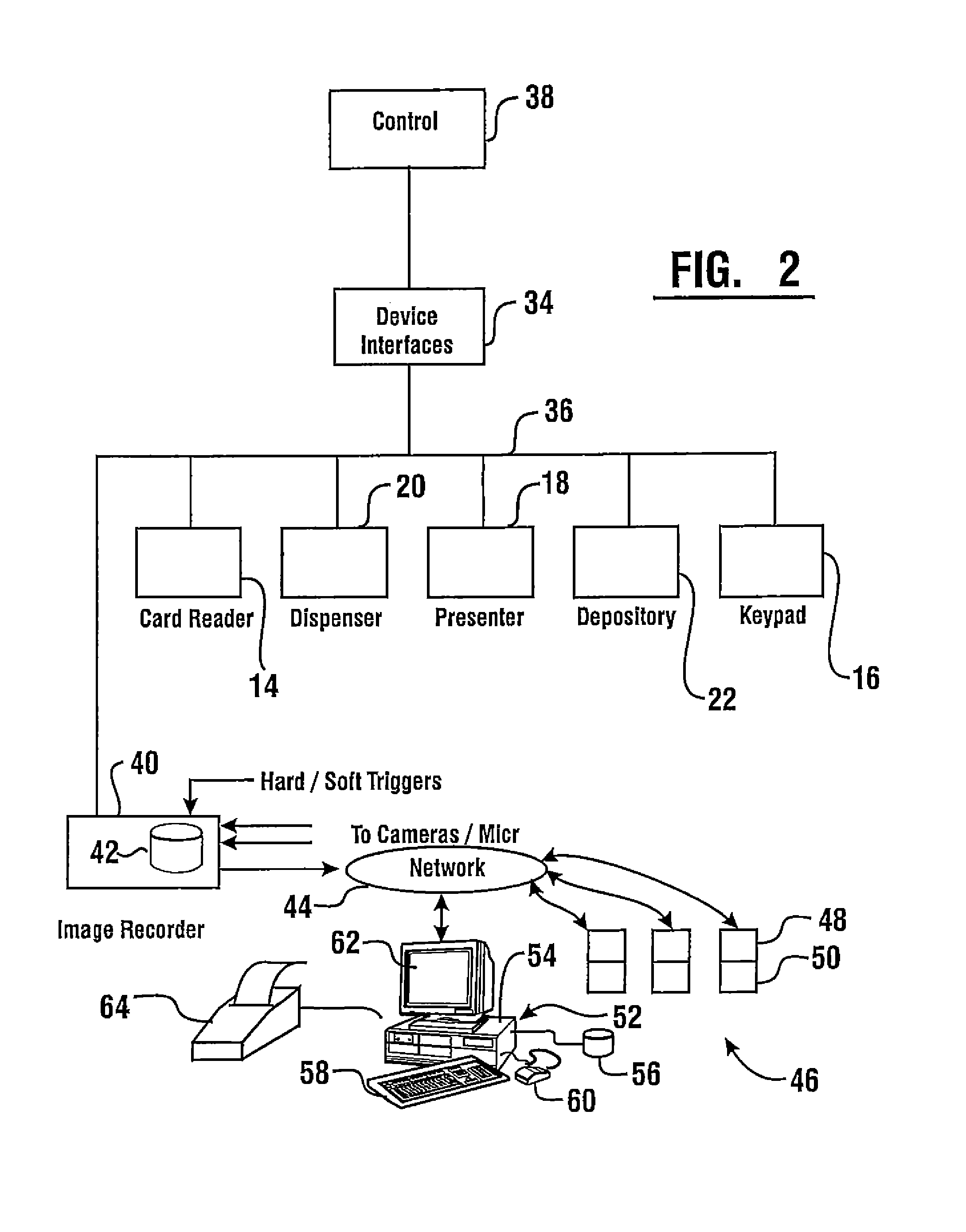

InactiveUS8474704B1Programmed more readilyEasy programmingComplete banking machinesFinanceData recordsFinancial transfer

An automated banking machine is part of a banking system that can operate to cause financial transfers responsive to data read from data bearing records, including user cards. The machine is in operative connection with a system operable to capture images related to activity that is conducted at or adjacent to the machine. The machine is positioned at a banking facility having a vault and an entrance. A plurality of cameras are positioned at the facility. Captured images can be analyzed at a remote monitoring center. The monitoring center can operate to assure that employees or customers of the banking facility can safely enter and / or exit the banking facility.

Owner:SECURITAS ELECTRONICS SECURITY INC

Cash dispensing automated banking machine with flexible display

InactiveUS20090289105A1Low production costEasy to operateComplete banking machinesFinanceRemote computerFlexible display

A portable terminal operates to cause financial transfers responsive to data read from data bearing records in the form of user cards. The user cards include credit and / or debit cards. Data corresponding to the card data is stored in at least one memory of the terminal. The terminal includes a wireless communication device. The terminal operates to wirelessly communicate data corresponding to card data wirelessly to one or more remote computers to cause financial transfers to or from selected accounts. The terminal also operates to provide outputs corresponding to account balances and to receive data corresponding to receipts.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

Automated Banking System Controlled Responsive to Data Bearing Records

ActiveUS20120145782A1Improved operating and servicingEnergy efficiencyComplete banking machinesFinanceCard readerElectric power

An automatic banking machine operates responsive to data read from data bearing records corresponding to authorized user or financial account data. The machine includes a card reader for reading data from user cards. The automated banking machine causes financial transfers related to financial accounts that correspond to data read from user cards. The automated banking machine also includes devices that control the supply of power to included devices to avoid exceeding power supply capacity.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

Automated banking machine that operates responsive to data bearing records

InactiveUS7922080B1Improve the immunityAvoid modificationComplete banking machinesFinancePasswordCard reader

An automated banking machine operates responsive to data read from data bearing records to cause financial transfers. The machine includes a card reader that operates to read card data from user cards. The card data corresponds to financial accounts. The automated banking machine includes a cash dispenser and the machine carries out transaction functions for consumers including dispensing cash. The automated banking machine may generate a password for the machine responsive to randomly generated data.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

Automated banking machine that operates responsive to data bearing records

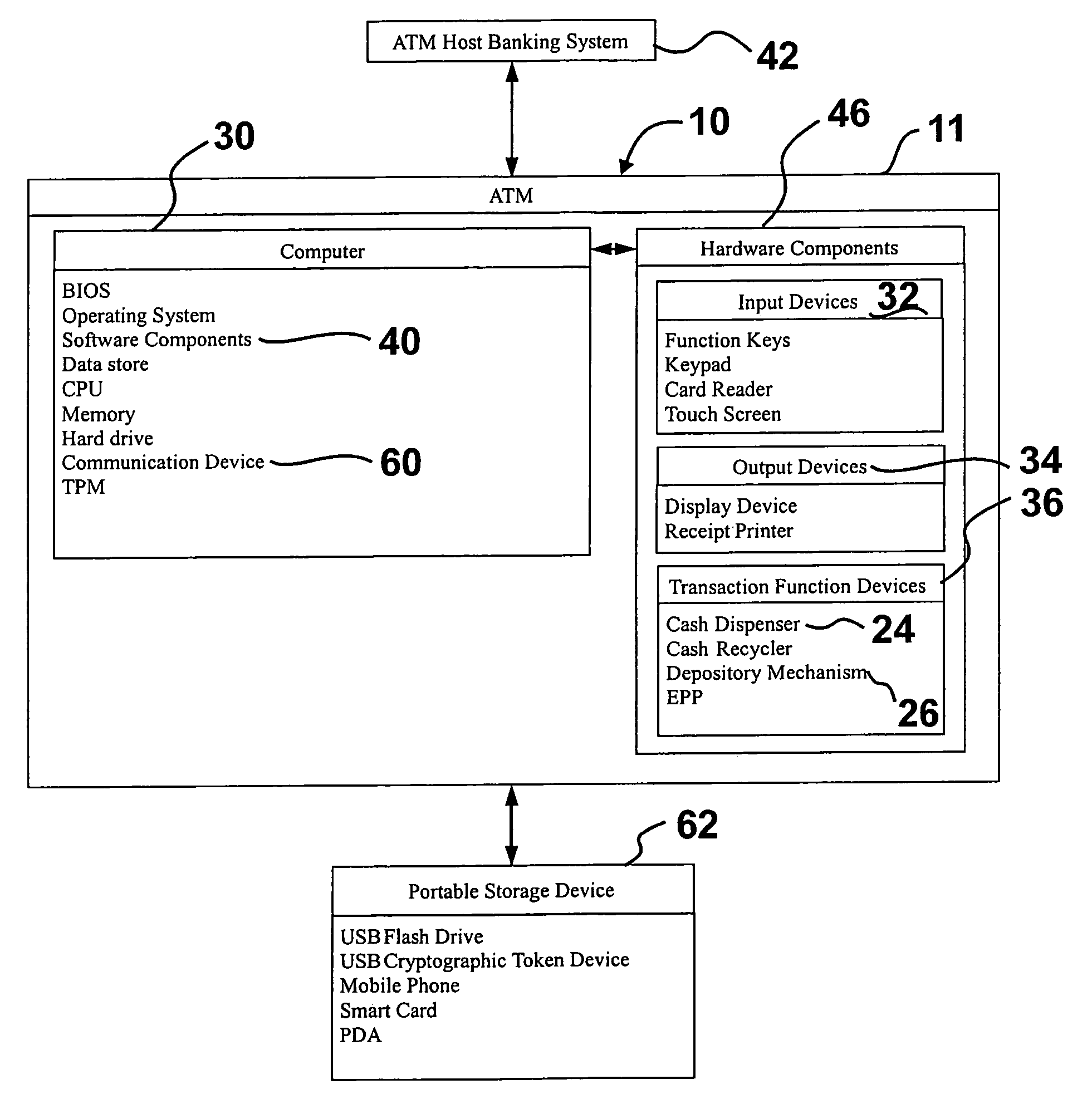

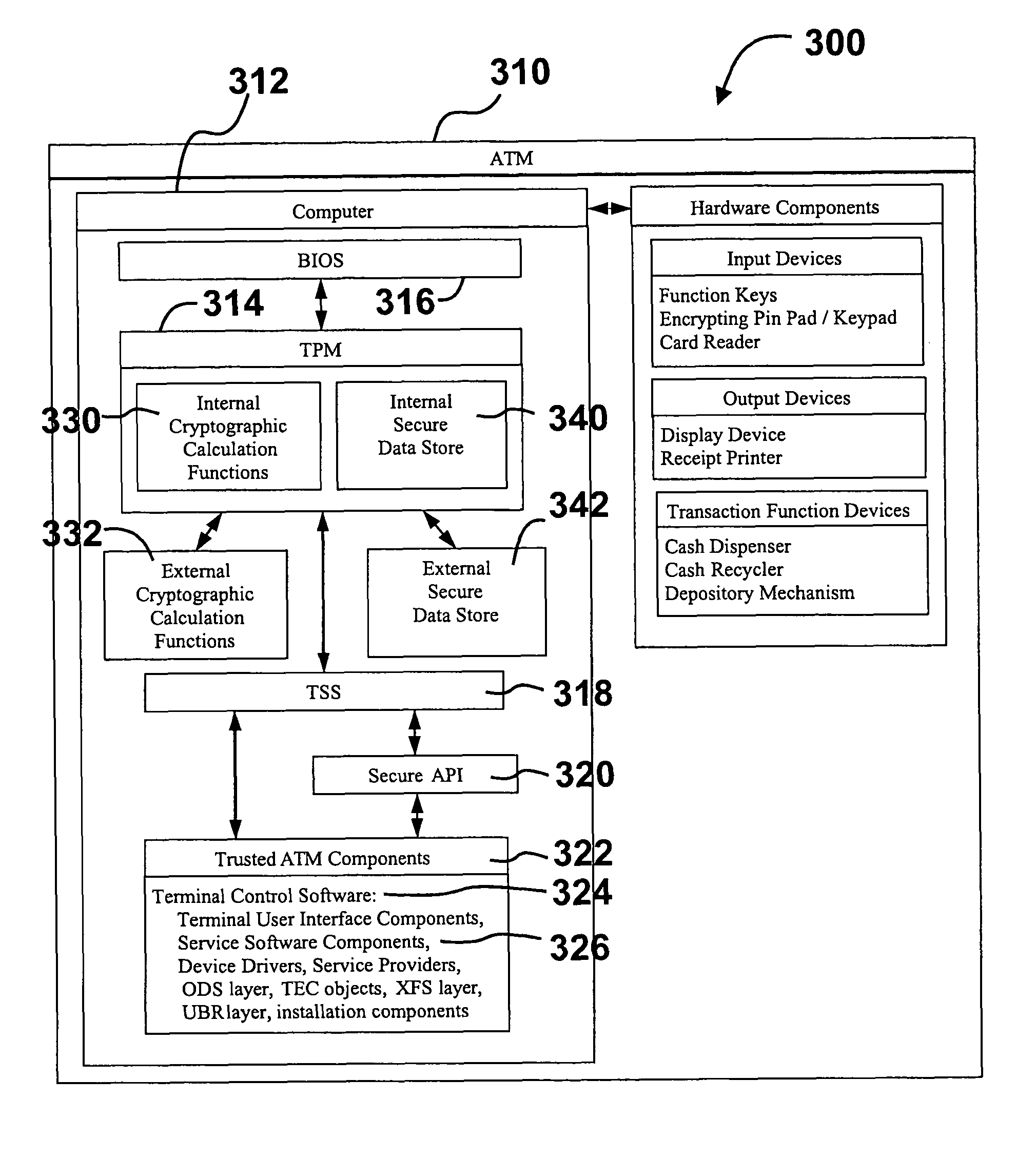

InactiveUS7967193B1Improve the immunityAvoid modificationComplete banking machinesFinanceSecure communicationTrusted Platform Module

An automated banking machine operates responsive to data read from data bearing records to cause financial transfers. The machine includes a card reader that operates to read card data from user cards. The card data corresponds to financial accounts. The automated banking machine includes a cash dispenser and the machine carries out transaction functions for consumers including dispensing cash. The automated banking machine may comprise a trusted platform module in a computer of the machine. The trusted platform module may also be used to establish secure communication between components of the machine such as the card reader.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

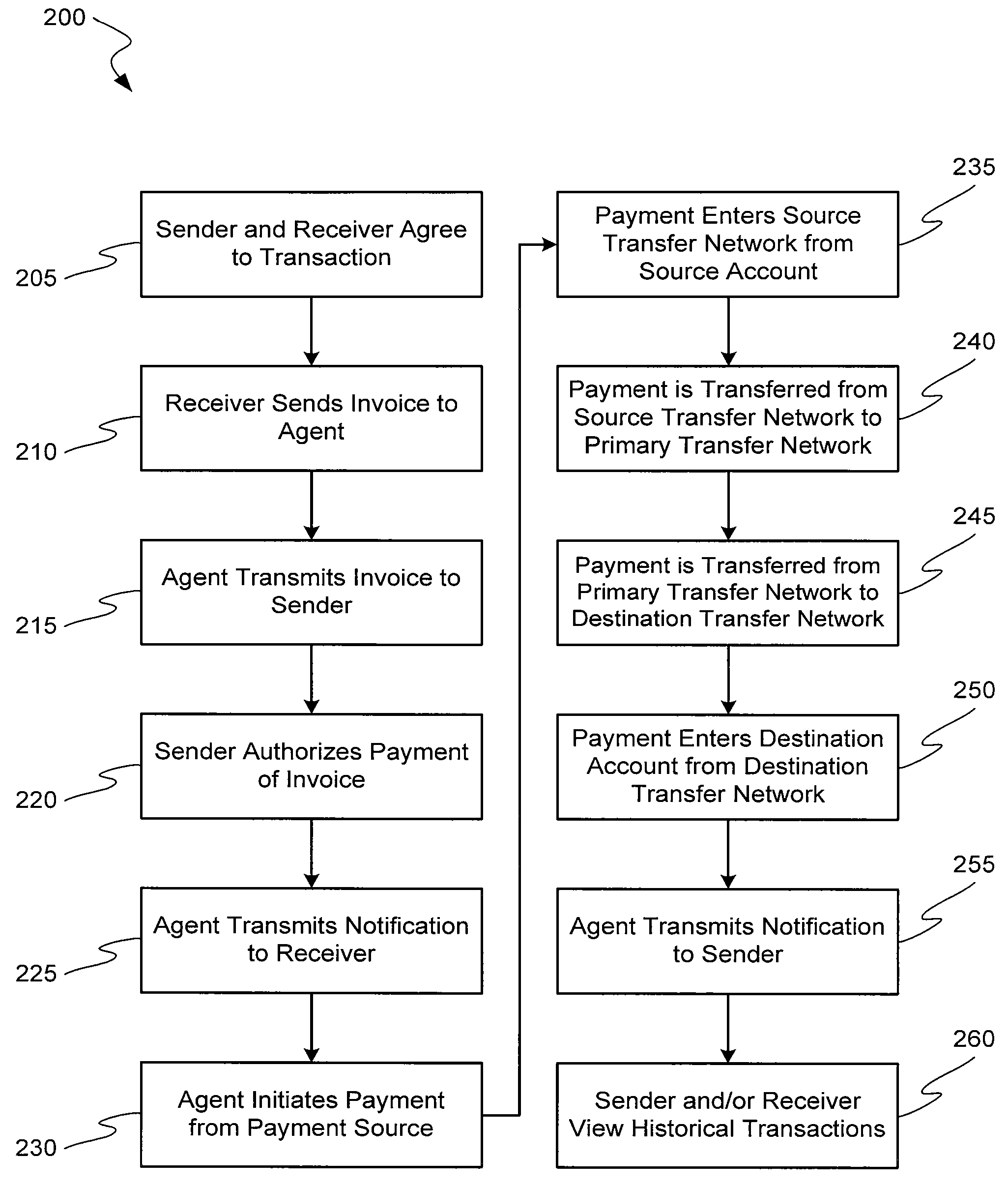

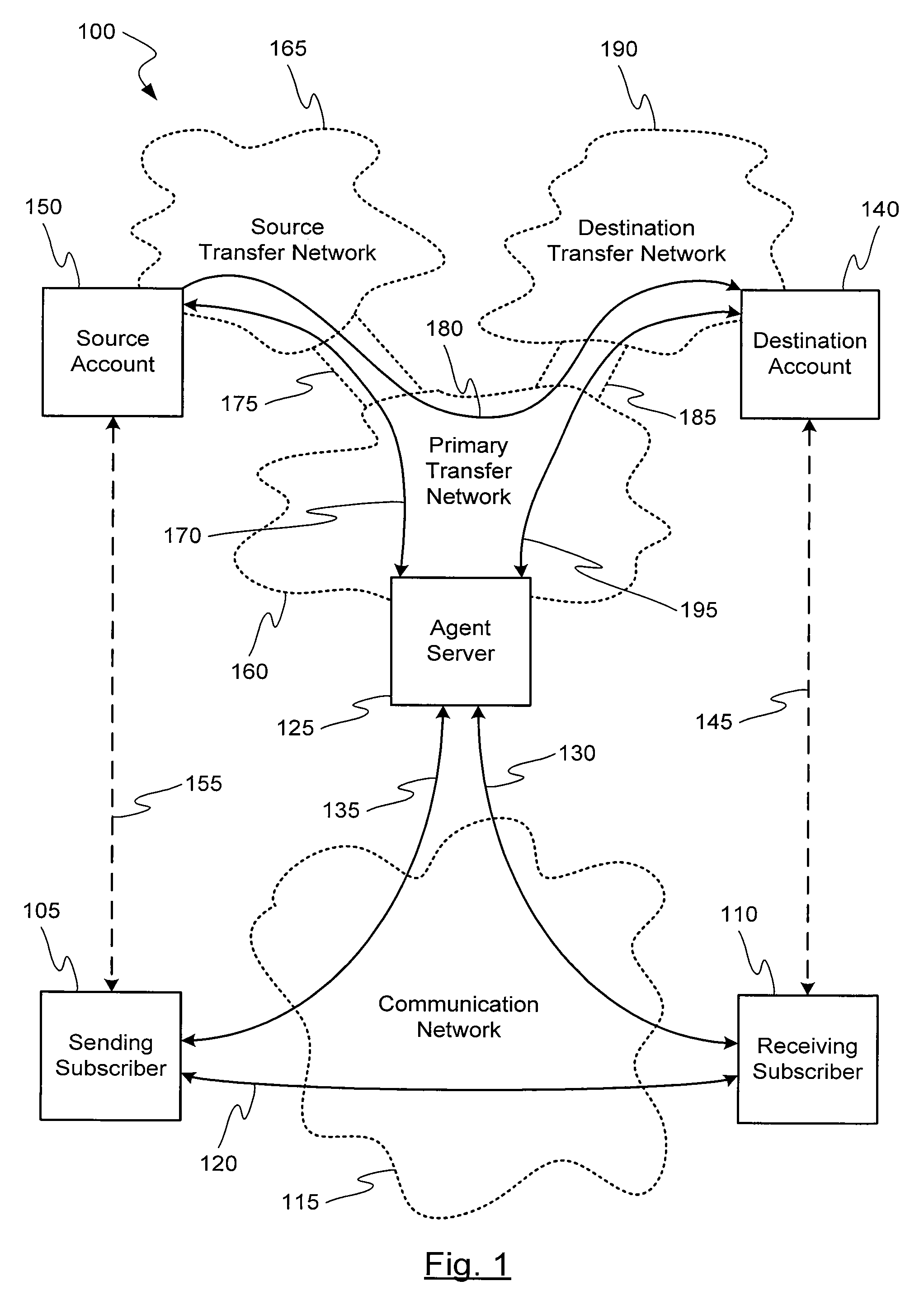

Consolidated Payment Options

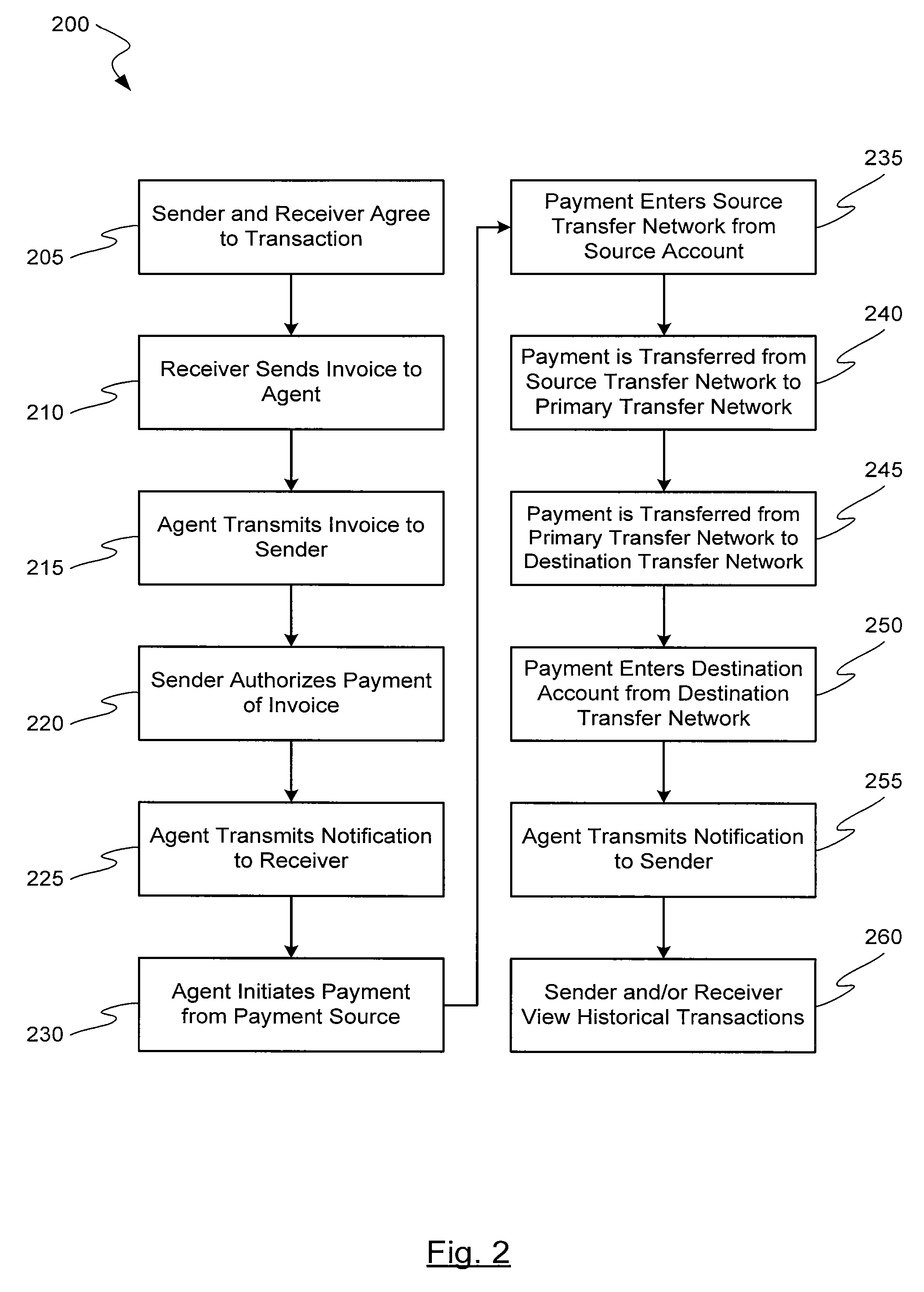

A system for making financial transfers between subscribers of a financial transfer service is disclosed. The system may include a receiving subscriber interface (RSI), a sending subscriber interface (SSI), and an agent server (AS). The RSI may be configured to accept a set of invoice information including an identifier of a destination account. The SSI may be configured to accept a set of payment information including an identifier of a source account. The AS may be configured to receive the set of invoice information and create an invoice based on the set of invoice information. The AS may also be configured to transmit the invoice and receive the set of payment information. The AS may also be configured to cause an amount of funds to be transferred from the source account on a source transfer network to the destination account on a destination transfer network via a primary transfer network.

Owner:THE WESTERN UNION CO

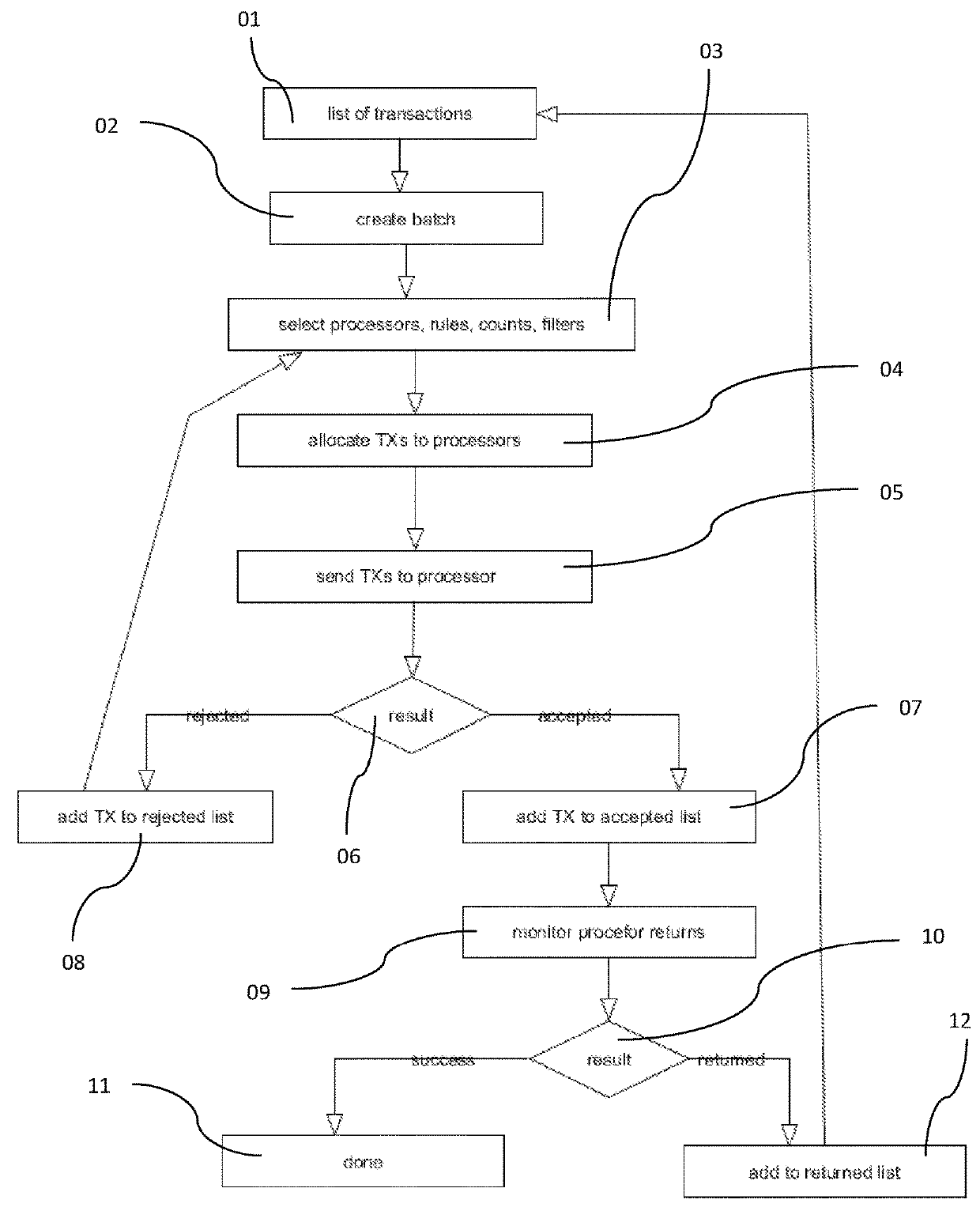

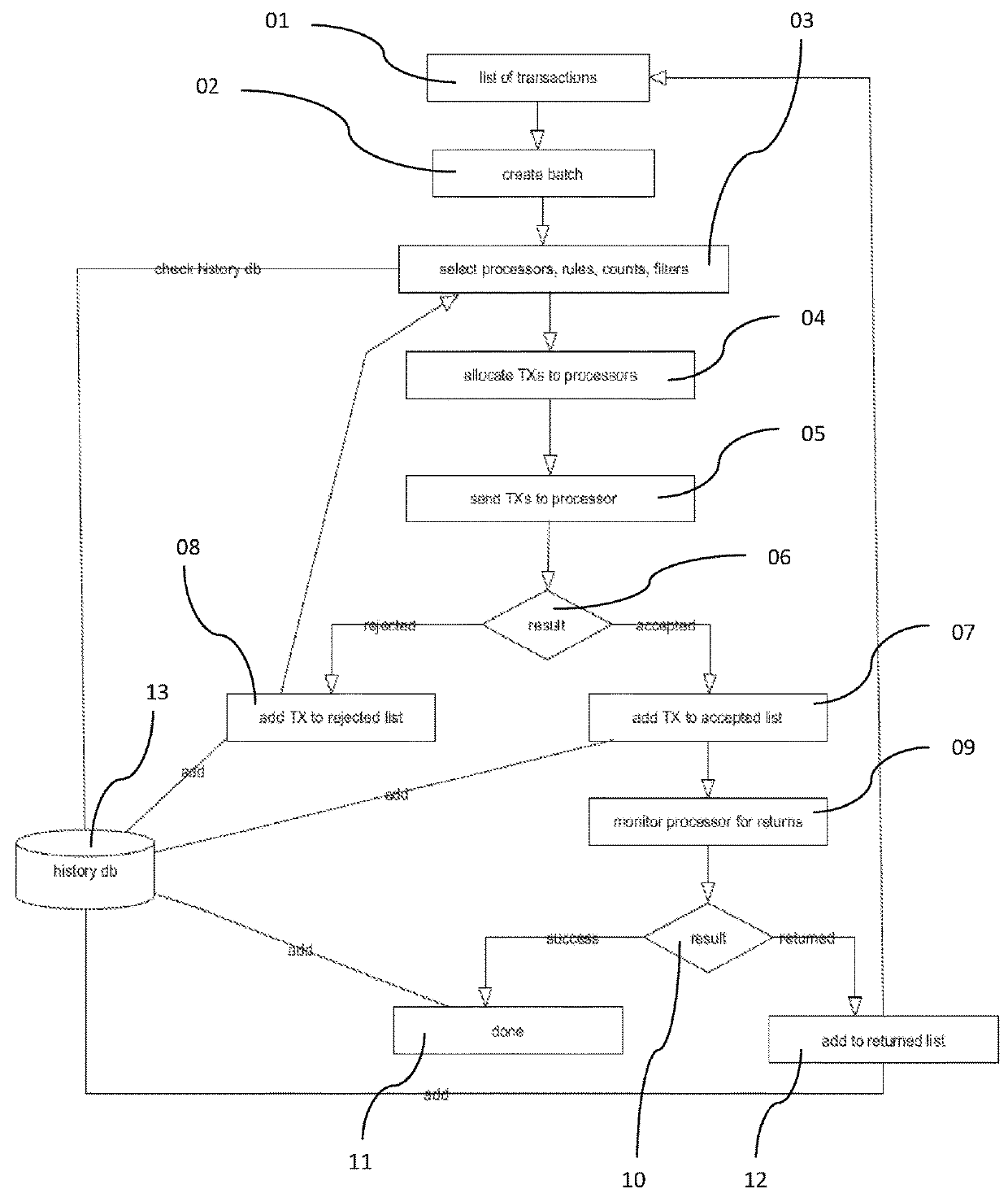

Systems and methods for monitoring and transferring financial capital

The present invention provides a financial transfer transaction system and method that utilizes a financial transfer transaction network and financial transfer module to monitor, coordinate, validate and implement financial transfer transactions as requested by merchants. The financial transfer transaction network will be administered by a provider, and will be able to automatically select a payment processor that is best suited to deal with a particular financial transfer transaction using specific payment methods, or a mix of different payment methods. A financial transfer transaction may be manipulated in a specific way within the financial transfer transaction network due to a number of different factors such as, but not limited to user selections, financial transfer transaction histories, financial transfer transaction user information, and generated sets of rules.

Owner:9160 4181 QUEBEC INC DBA NCR FINANCIAL SERVICES

Banking machine controlled responsive to data read from data bearing records

ActiveUS8540142B1Function increaseEasy to installComplete banking machinesAcutation objectsMachine controlComputer science

A banking system operates responsive to data read from data bearing records. The system includes an automated banking machine comprising a card reader. The card reader includes a movable read head that can read card data along a magnetic stripe of a card that was inserted long-edge first. The card reader includes a card entry gate. The gate is opened for a card that is determined to be properly oriented for data reading. The card reader can encrypt card data, including account data. The machine also includes a PIN keypad. The card reader can send encrypted card data to the keypad. The keypad can decipher the encrypted card data. The keypad can encrypt both deciphered card data and a received user PIN. The card data and the PIN are usable by the machine to authorize a user to carry out a financial transfer involving the account.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

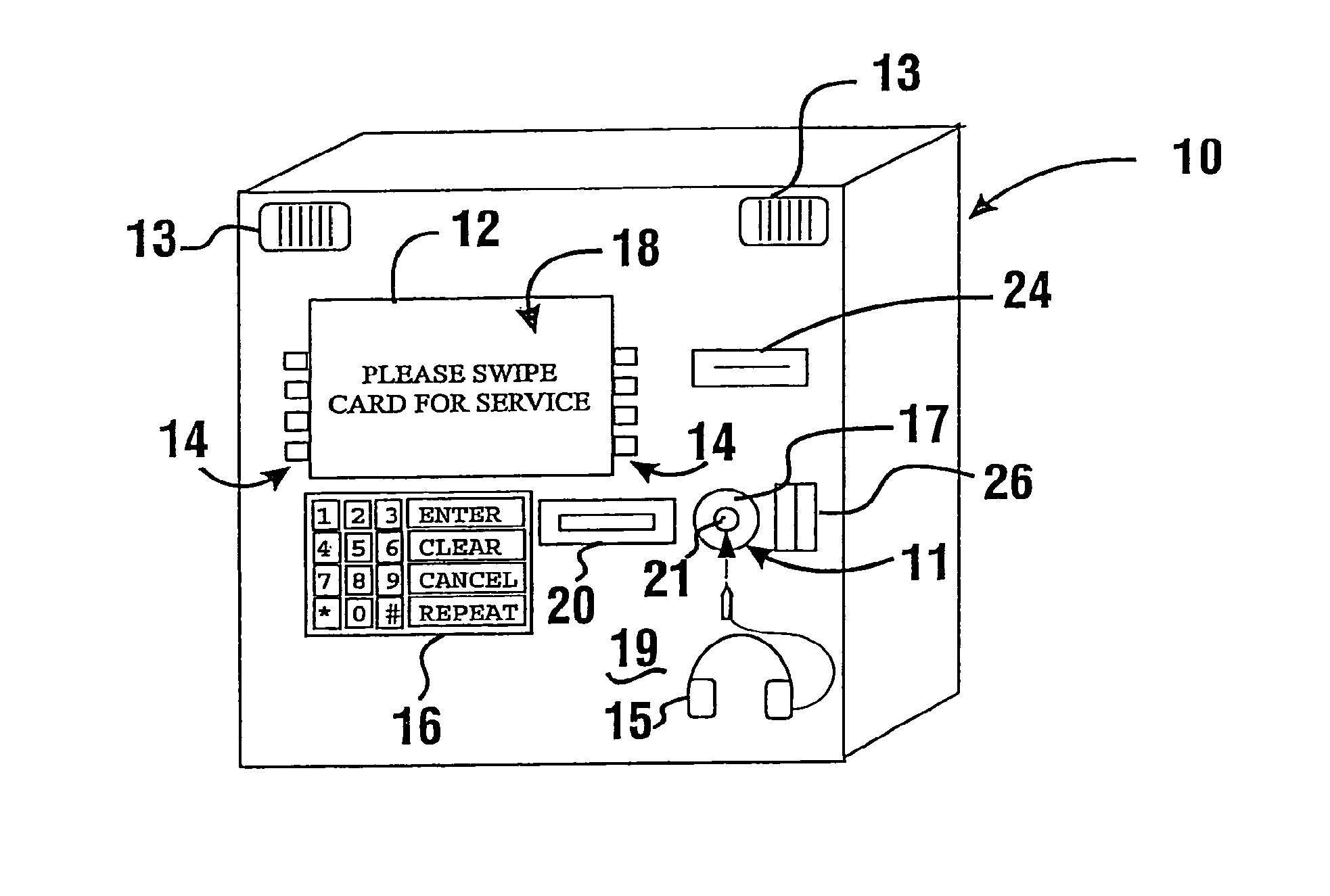

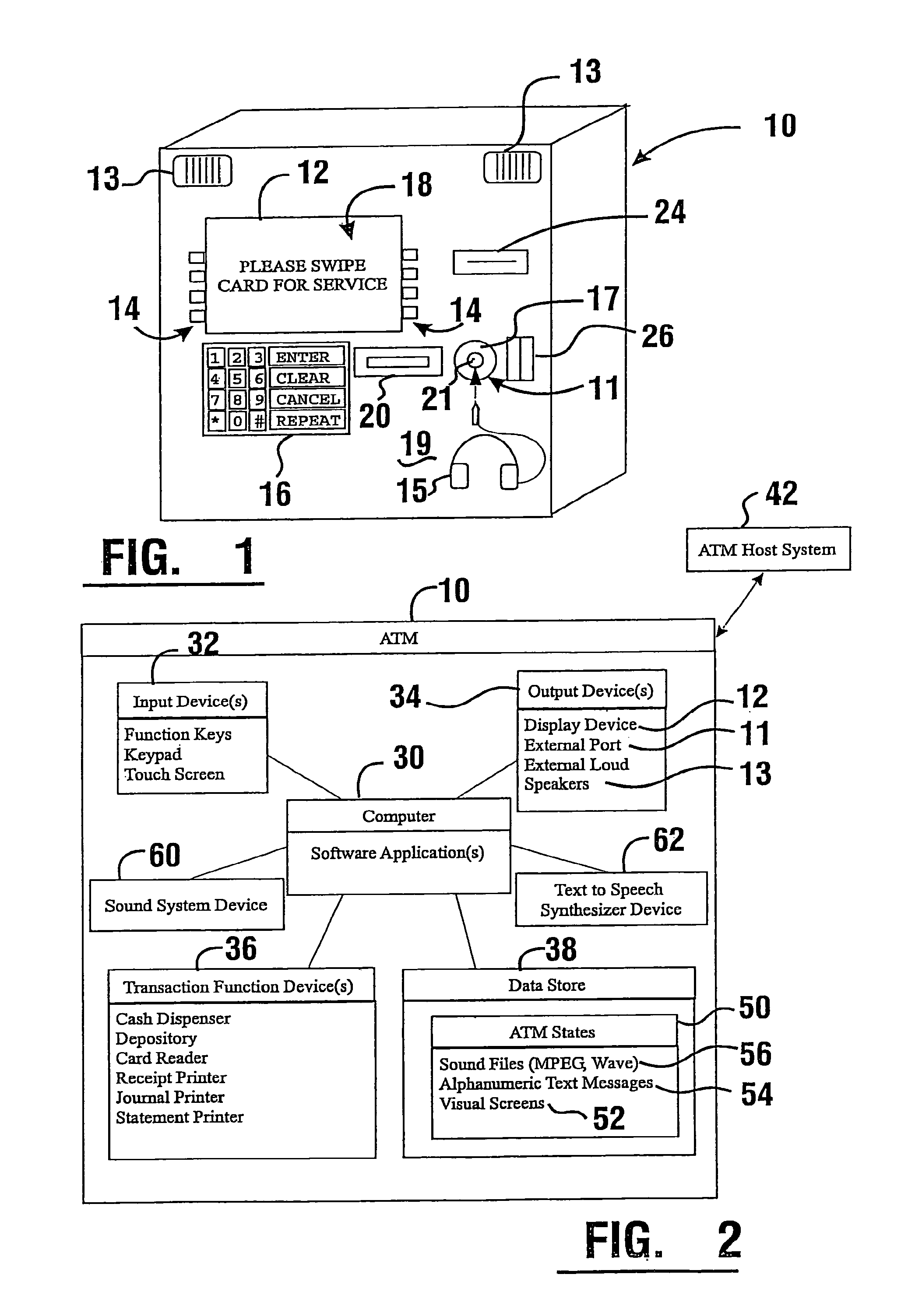

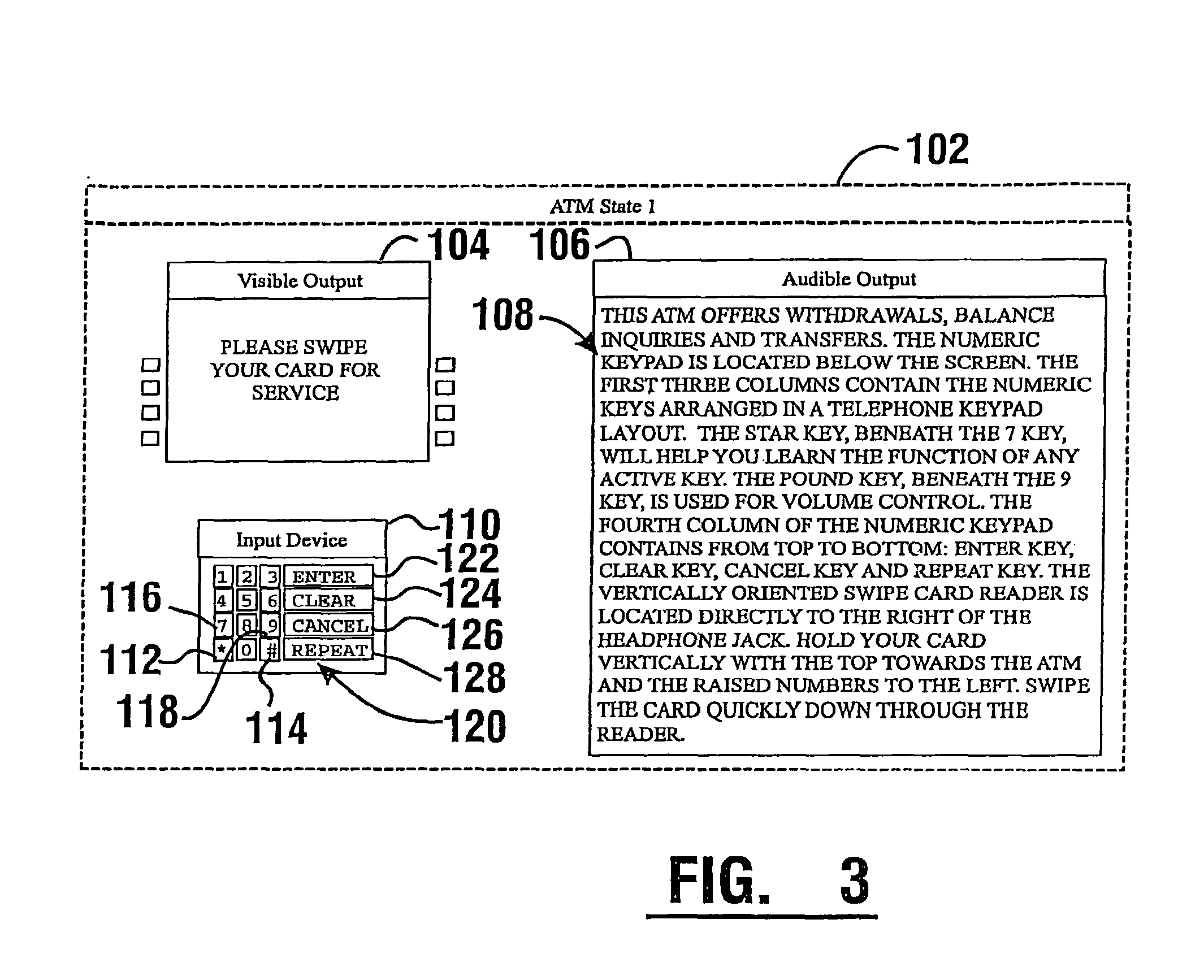

Automated banking machine that operates responsive to data bearing records

An automated banking machine system operates to cause financial transfers responsive to data read from data bearing records. The system is operative to read a financial card bearing account indicia with a card reader. A user is able to perform at least one banking operation responsive to account indicia read by the card reader from the card. The banking operations include dispensing cash and accessing financial accounts. The machine is operative to produce an audio output including verbal information through a headphone port to a headphone.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

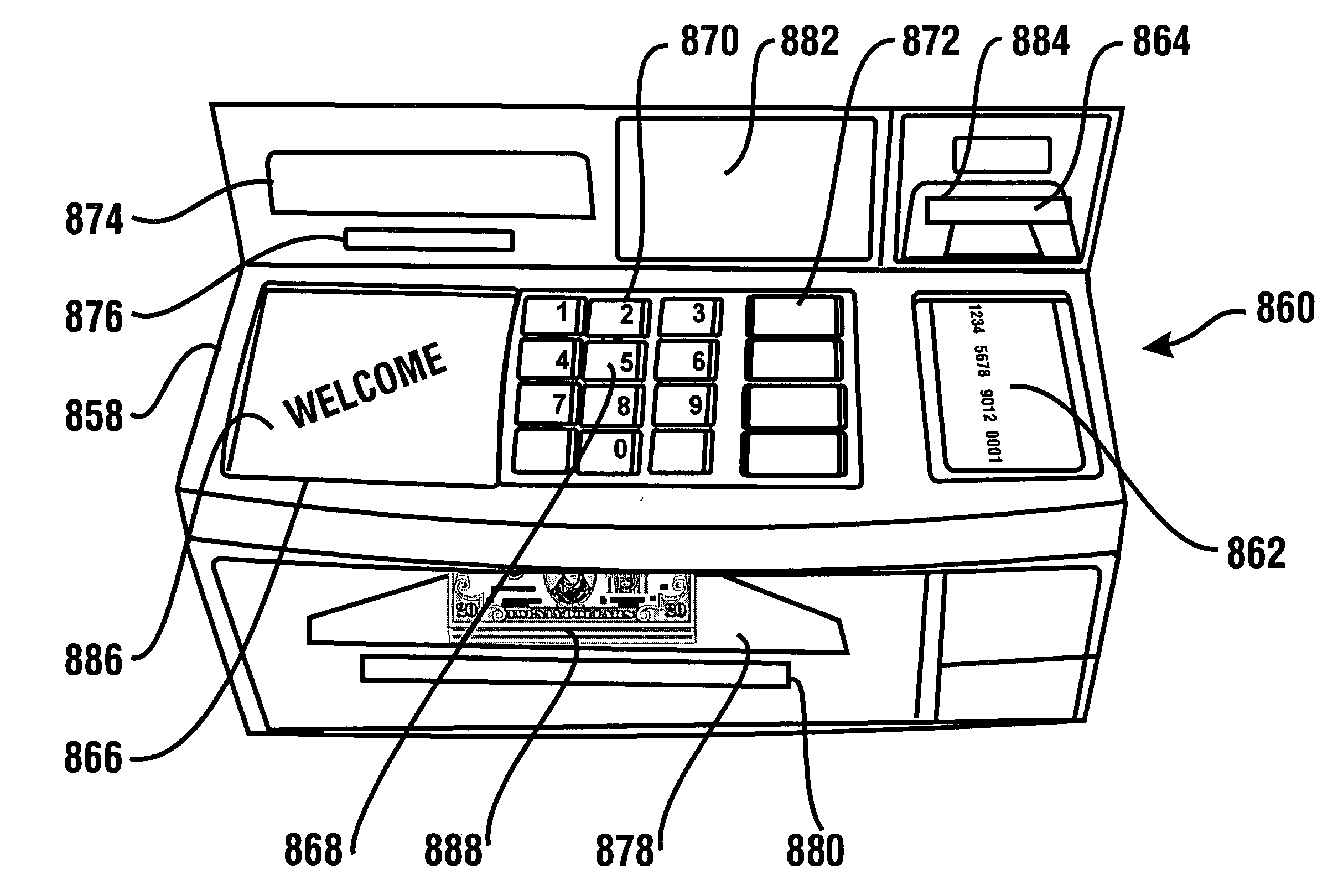

Check cashing automated banking machine

An automated banking machine is operated at least in part to data read from data bearing records. The machine is operative to carry out a financial transfer responsive at least in part to a determination that data read through a card reader of the machine corresponds to a financial account that is authorized to conduct a transaction through operation of the machine. The machine also includes a check acceptor operative to receive checks from machine users. The check acceptor is operative image checks and data resolved from check images is used in operation of the machine to cause financial transfers.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

Check cashing banking system controlled responsive to data bearing records

InactiveUS8893959B1Simpler customer interfaceOptimizationFunction indicatorsPayment architectureChequeCard reader

An automated banking machine is operable to cause financial transfers responsive to data read from data bearing records. The machine includes a card reader that can read from cards, user data that corresponds to financial accounts. The machine can operate responsive to the read card data to carry out transactions that transfer and / or allocate funds between accounts. The machine can provide a transaction receipt. The machine includes a cash dispenser to dispense cash to machine users. Value of dispensed cash can be assessed to an account which corresponds to read card data. The machine also includes a check acceptor device that can receive checks from users. The machine can image a received check and then read check data from the check image. An account determined from read card data can be credited the amount of the check.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

Banking system controlled responsive to data bearing records

InactiveUS7861924B1Easy maintenanceEasy to detectComplete banking machinesFinanceData memoryCard reader

An automated banking machine operates to cause financial transfers responsive to data read from data bearing records. The automated banking machine includes a card reader that is operative to read card data corresponding to a user financial account. The card data is linked in at least one data store to an indication that the card data corresponds to an authorized financial account to enable operation of the automated banking machine. The card data is also linked in the at least one data store to a mobile communication device (i.e., cell phone of an owner associated with the financial account). In response to receipt of card data and a transaction request from an automated banking machine, contact data for the owner's cell phone is determined and a message notifying the owner of the requested transaction is sent. The transaction is completed only if the owner provides a responsive message granting permission for the transaction to proceed. Alternatively or in addition transaction authorization may be based on the then current location of the owner's cell phone adjacent to the automated banking machine, and / or other criteria.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

Banking machine controlled responsive to data read from data bearing records

ActiveUS9038891B2Function increaseEasy to installComplete banking machinesFinanceMachine controlData records

A banking system operates responsive to data read from data bearing records. The system includes an automated banking machine comprising a card reader. The card reader includes a movable read head that can read card data along a magnetic stripe of a card that was inserted long-edge first. The card reader includes a card entry gate. The gate is opened for a card that is determined to be properly oriented for data reading. The card reader can encrypt card data, including account data. The card data is usable by the machine to authorize a user to carry out a financial transfer involving the account.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

Cash dispensing automated banking machine

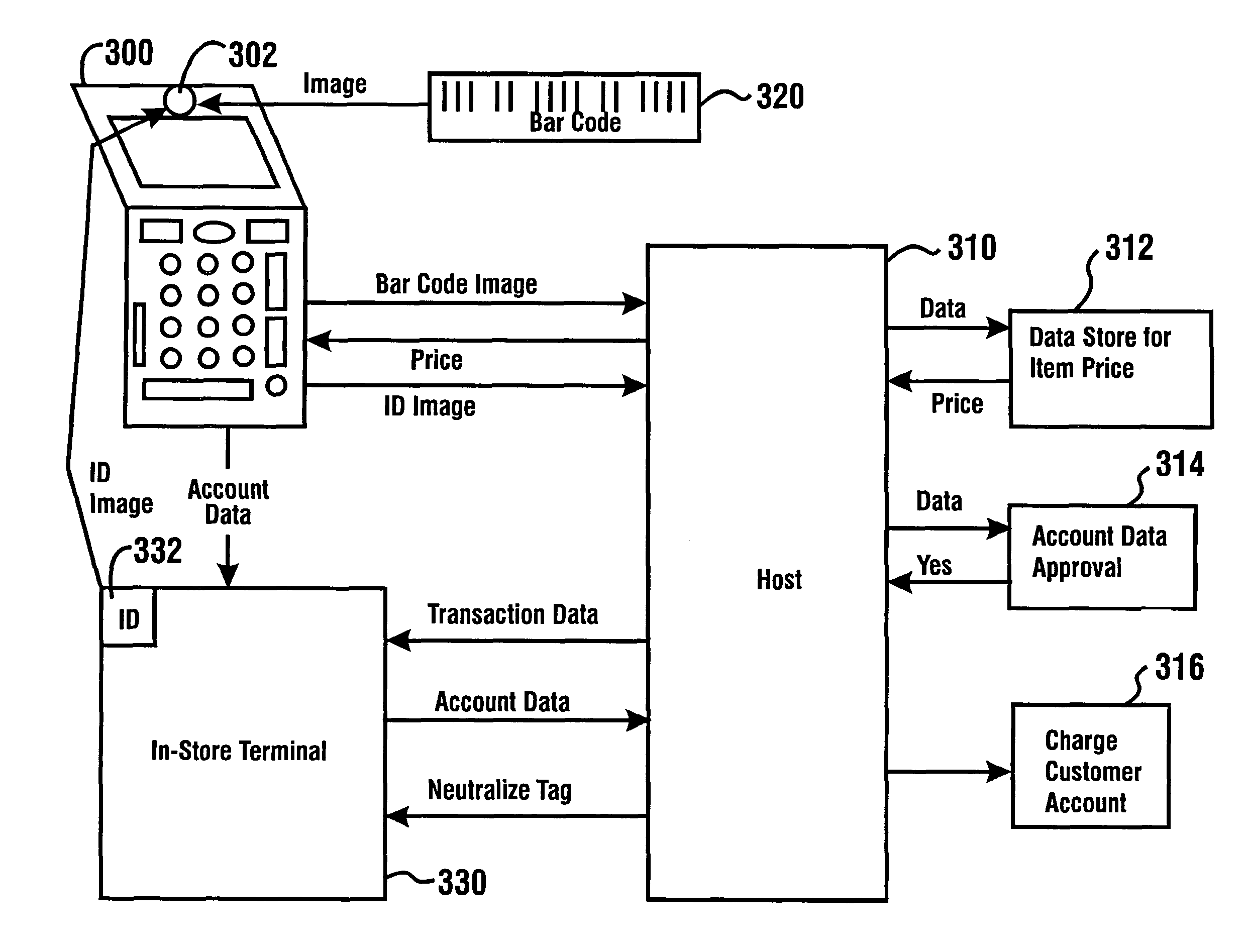

An automated banking machine that operates responsive to data bearing records such as user cards includes a user interface having electronic ink displays. Displays can be used as identification labels. A display identifying the function of a transaction function device can be located adjacent to that device. Displays can also be used to provide instructions to machine users. A display on how to insert a card into the ATM can be located adjacent the card input slot. A system that operates to carry out financial transfers operates in response to data read from data bearing records. A cell phone having a camera or other reader operates to cause item identifying data and account data to be transmitted to a transaction system to enable item purchase.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

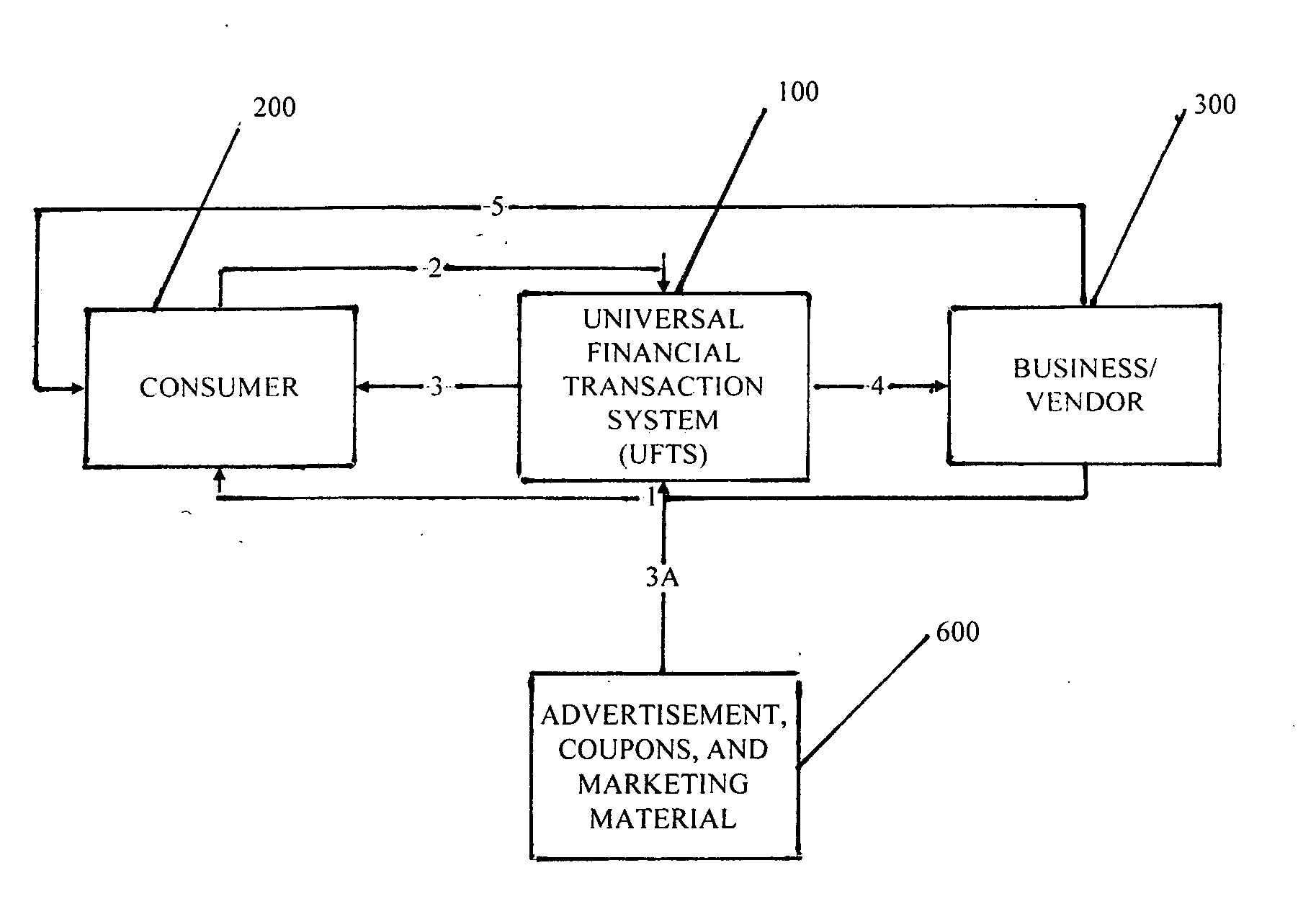

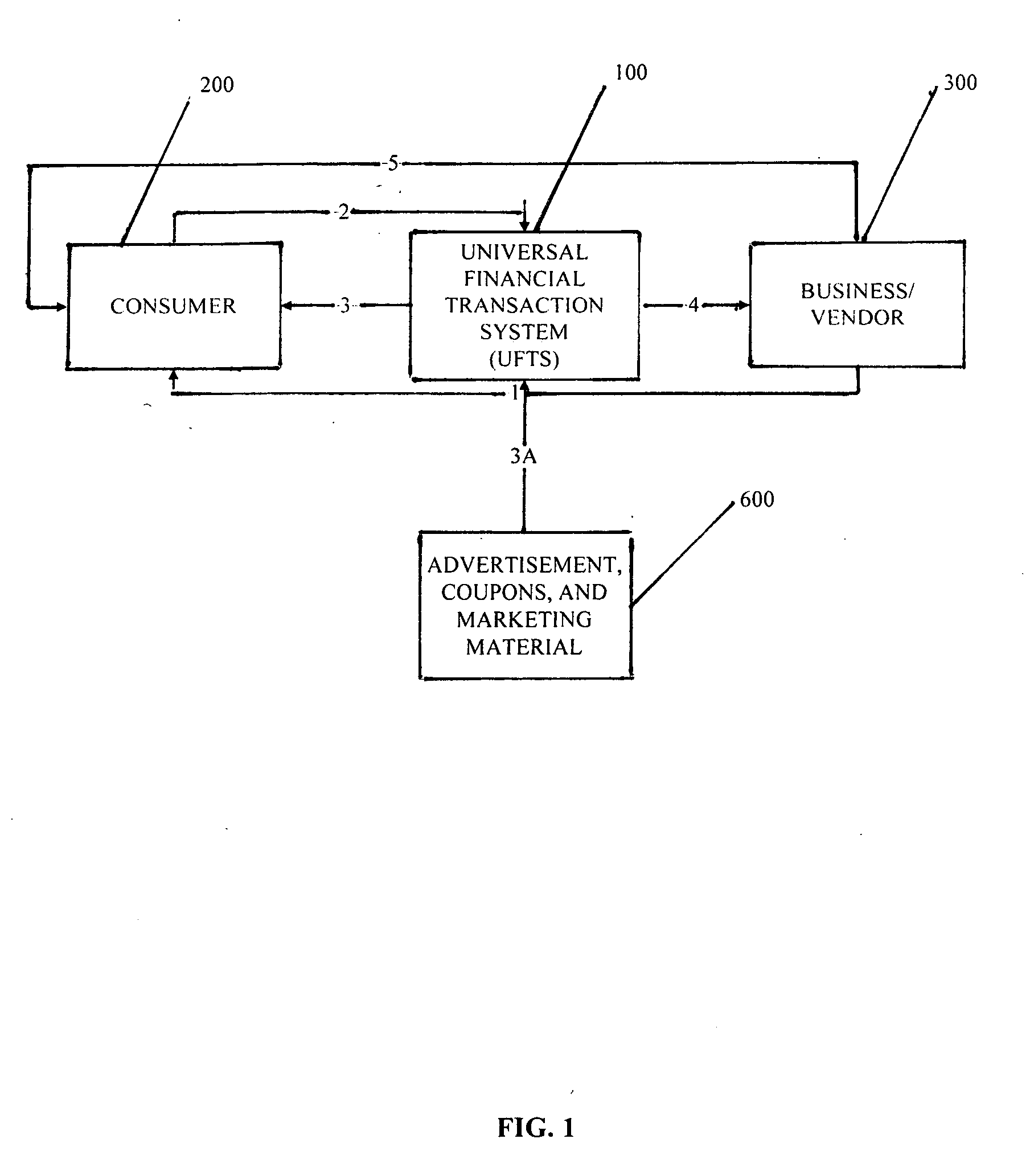

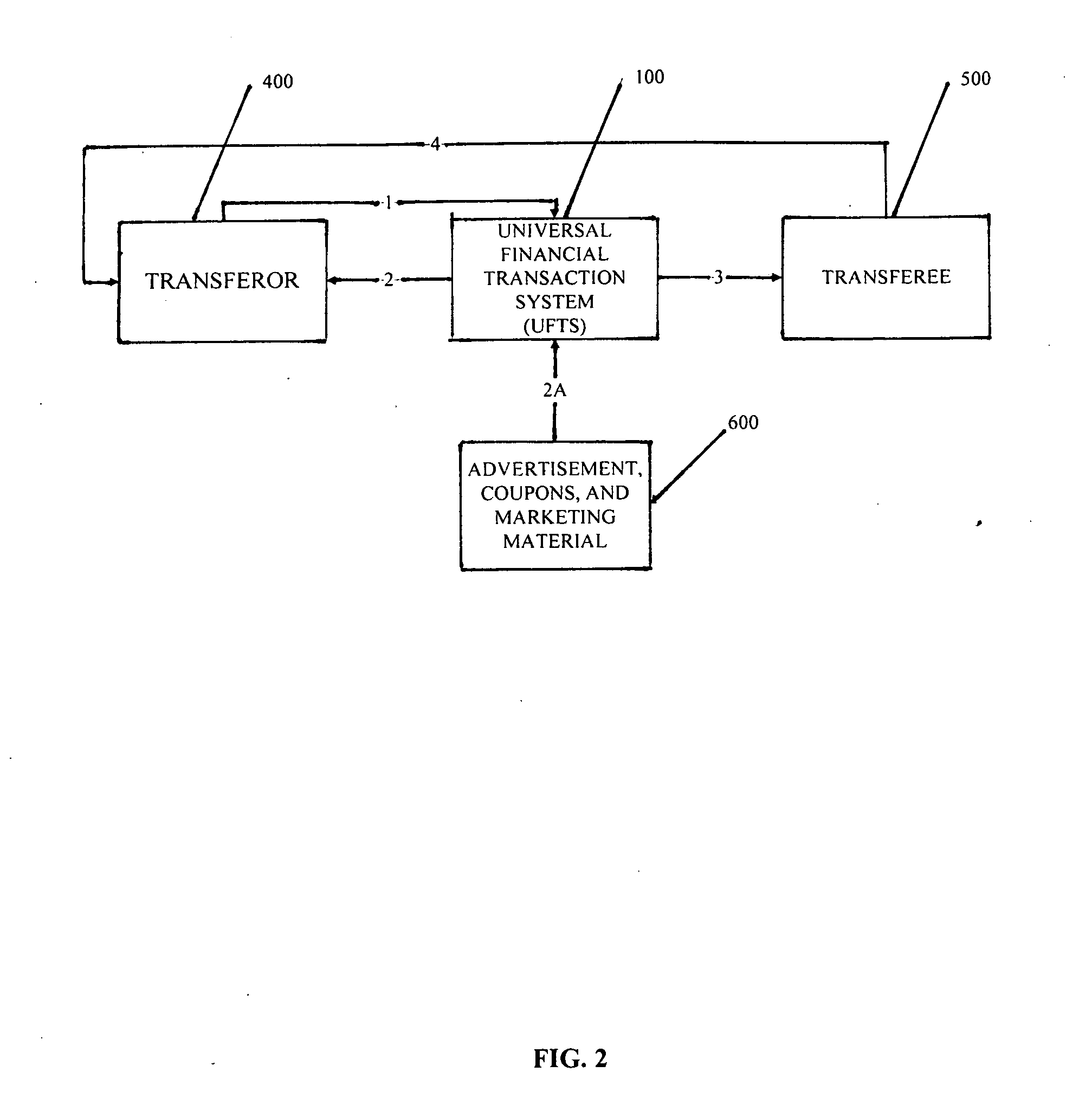

Universal financial transaction system

The Universal Financial Transaction System (UFTS) is an improved electronic payment system which uses encrypted software e to make financial transfers electronically. The UFTS operation is not limited to personal computers like the current online payment system. Moreover, it can be downloaded and operate on any electronic device such as mobile phones, PDA's, pocket computers, personal computer, electronic cash register or point of sale system. This improvement makes the UFTS as user friendly as any credit or debit card and as functional as any online banking system; thus it can be used to purchase items in any retail or online business and it can be used to transfer funds to any individual or entity among United States currency and any foreign currency. The UFTS does not charge the end-user for the financial transaction instead it generate its own revenue through transmittal of advertisement to the user's electronic device.

Owner:DORO JOSHUA A

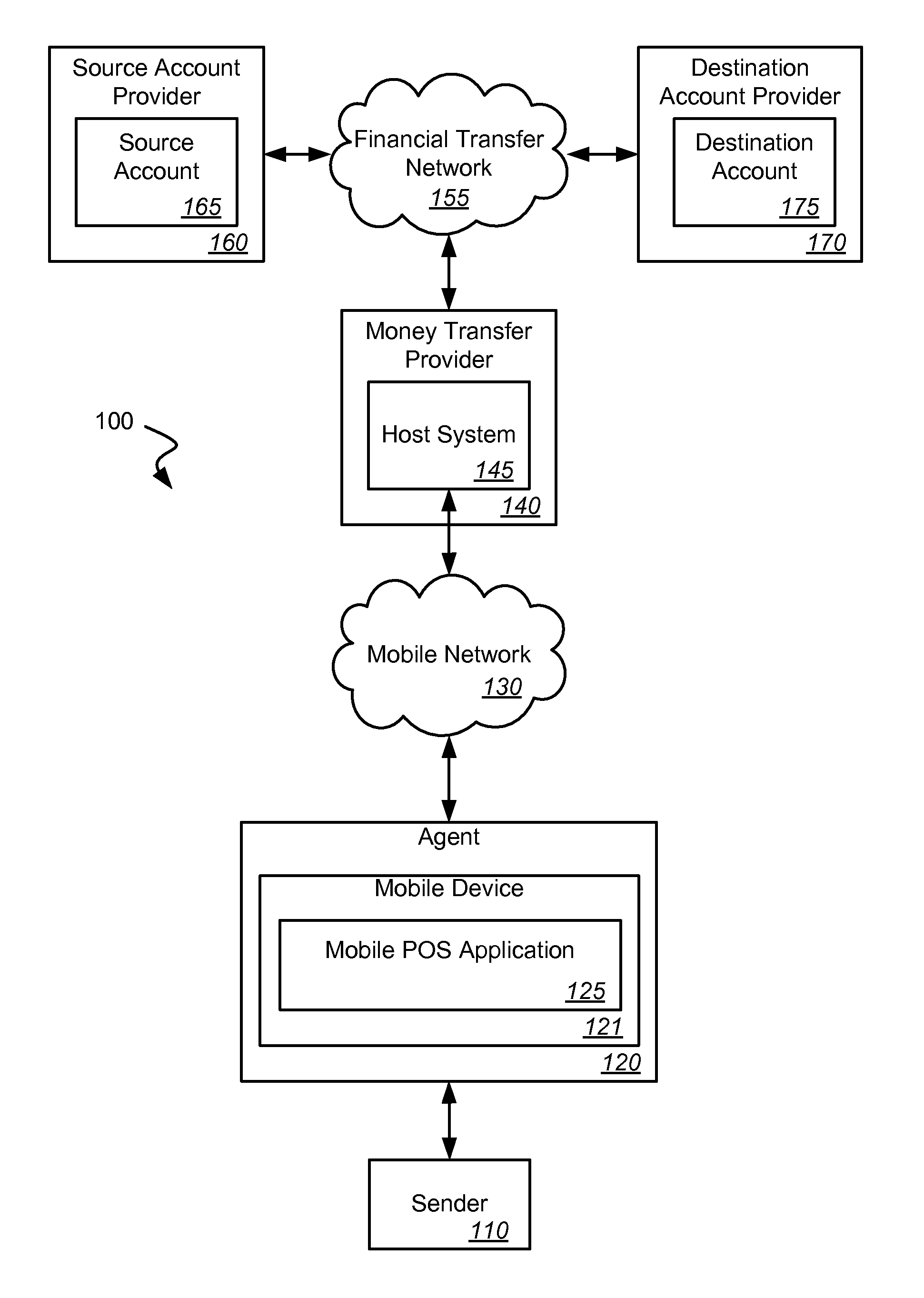

Mobile agent point-of-sale (POS)

Systems and methods are disclosed for conducting transactions and financial transfers utilizing a mobile device communicatively coupled with a mobile communications network and executing a mobile point-of-sale application. According to some embodiments, the mobile point-of-sale application is adapted to conduct money transfer transactions by communicating transaction information through the mobile communications network to a money transfer provider system that processes the money transfer and communicates receipt information to the mobile point-of-sale application. Additionally, according to some embodiments, an account associated with an agent of the money transfer provider can be used in money transfer transactions conducted by the mobile point-of-sale application.

Owner:THE WESTERN UNION CO

Apparatus, systems and methods for wirelessly transacting financial transfers, electronically recordable authorization transfers, and other information transfers

The present invention provides apparatus, systems and methods to wirelessly pay for purchases, electronically interface with financial accounting systems, and electronically record and wirelessly communicate authorization transactions using Personal Digital Assistant (“PDA”) (also referred to as Personal Intelligent Communicators (PICs), and Personal Communicators), palm computers, intelligent handheld cellular and other wireless telephones, and other personal handheld electronic devices configured with infrared or other short range data communications (for referential simplicity, such devices are referred to herein as “PDA's”). The present invention further provides apparatus, firmware, software programs and computer-implemented methods for making service and / or sale service charge payments for credit card charges, debit card charges, electronic cash transfers, ticket and other like financial transactions and for other types of transactions, such as for electronic coupons, where the amount of the transaction is for a small amount of money, such as, for example, less than $5.00.

Owner:SENTEGRA

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com