Patents

Literature

164 results about "Electronic cash" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Electronic cash was until 2007 the debit card system of the German Banking Industry Committee, the association which represents the top German financial interest groups. Usually paired with a Transaction account or Current Account, cards with an Electronic Cash logo were only handed out by proper credit institutions. An electronic card payment was generally made by the card owner entering their PIN (Personal Identification Number) at a so-called EFT-POS-terminal (Electronic-Funds-Transfer-Terminal). The name “EC” originally comes from the unified European checking system Eurocheque. Comparable debit card systems are Maestro and Visa Electron. Banks and credit institutions who issued these cards often paired EC debit cards with Maestro functionality. These combined cards, recognizable by an additional Maestro logo, were referred to as “EC/Maestro cards”.

Mobile internet access

InactiveUS6804720B1Accounting/billing servicesMultiple digital computer combinationsCable Internet accessIp address

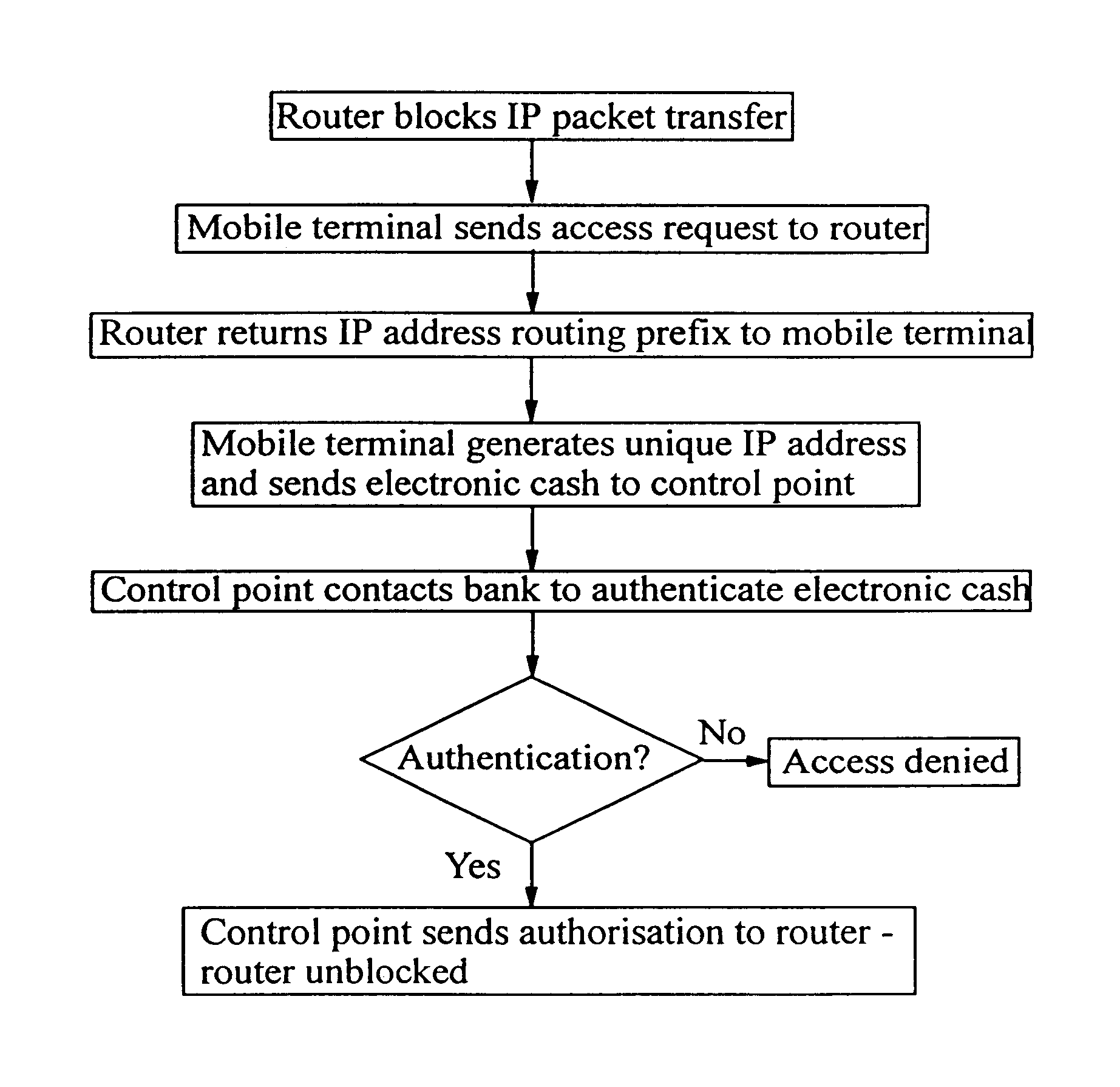

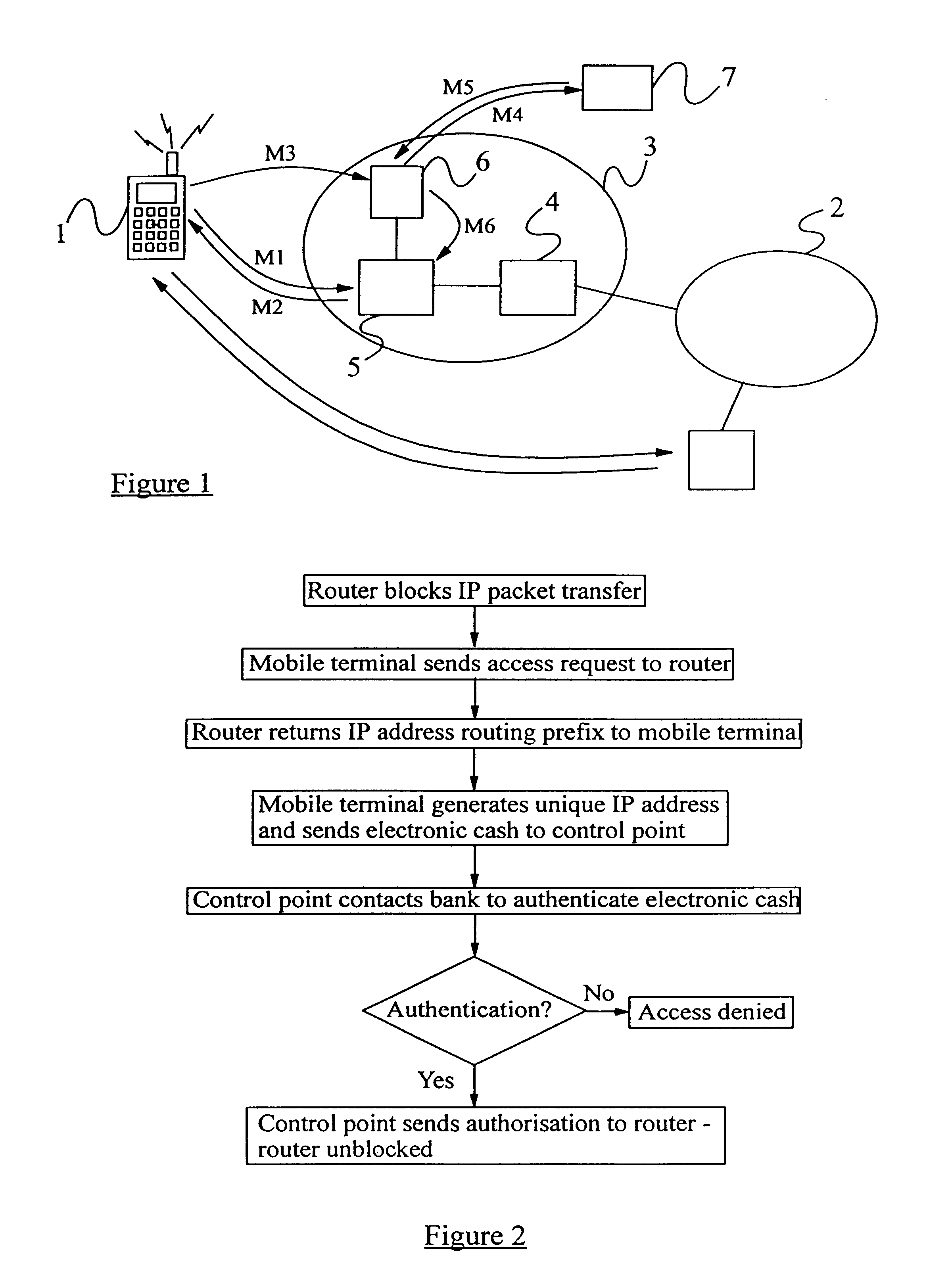

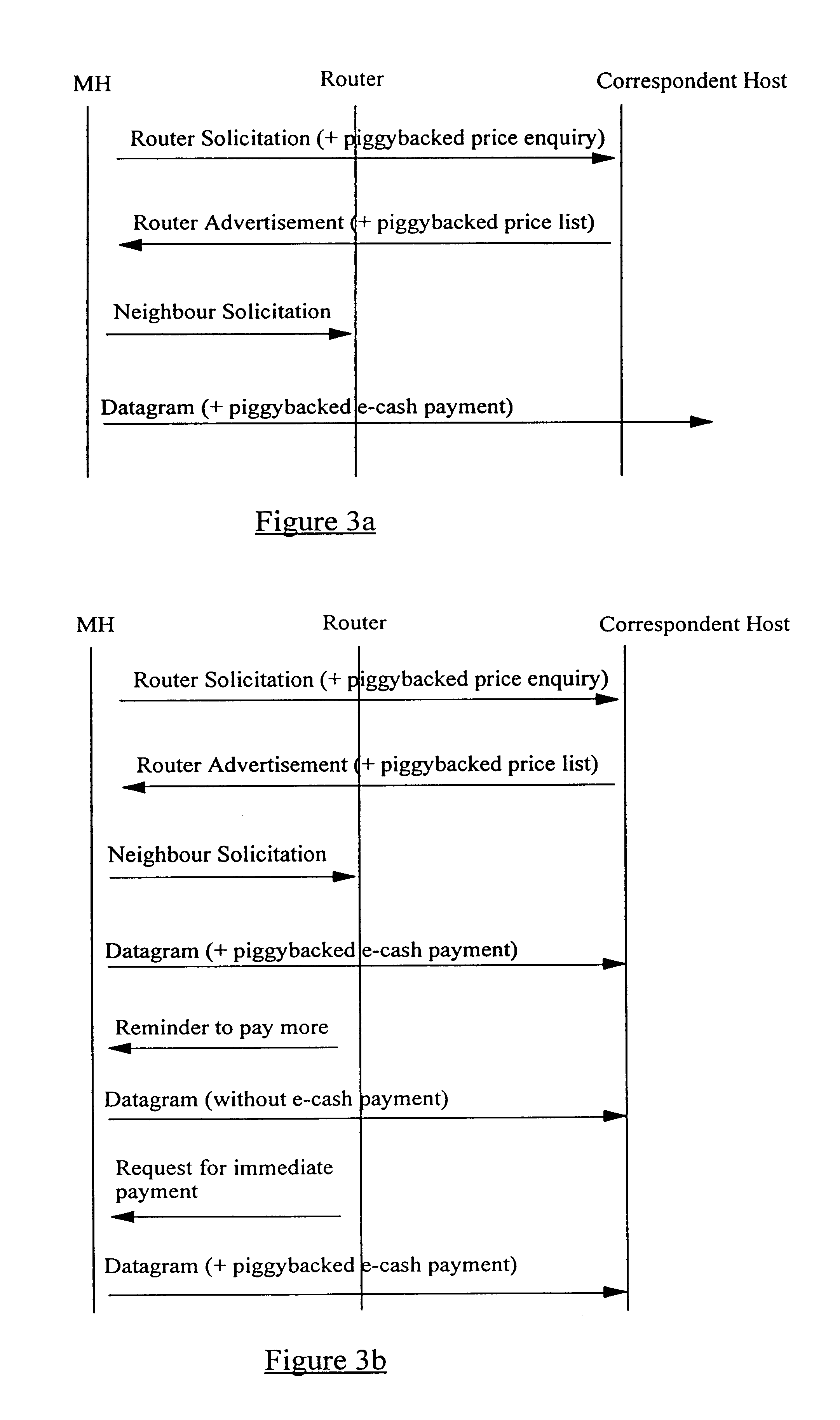

A method of authorizing an Internet Protocol (IP) enabled mobile host 1 to access the Internet 2 via an wireless LAN, GSM, UMTS access network 3 comprises initially sending an IP access request from the mobile host 1 to an IP router 5 within the access network 3. In response to receipt of said access request at the IP router 5, an IP address routing prefix is sent from the IP router 5 to the mobile host 1. Electronic cash is then forwarded from the mobile host 1 to a control point 6 within the access network 3. The control point 6 confirms the authenticity and / or sufficiency of the electronic cash and, providing that confirmation is made, sends an authorization message to the IP router 5. The IP router 5 blocks the transmission of IP packets between the mobile host 1 and the Internet 2 prior to receipt of the authorization message and permits the passage of IP packets only after an authorization message has been received.

Owner:TELEFON AB LM ERICSSON (PUBL)

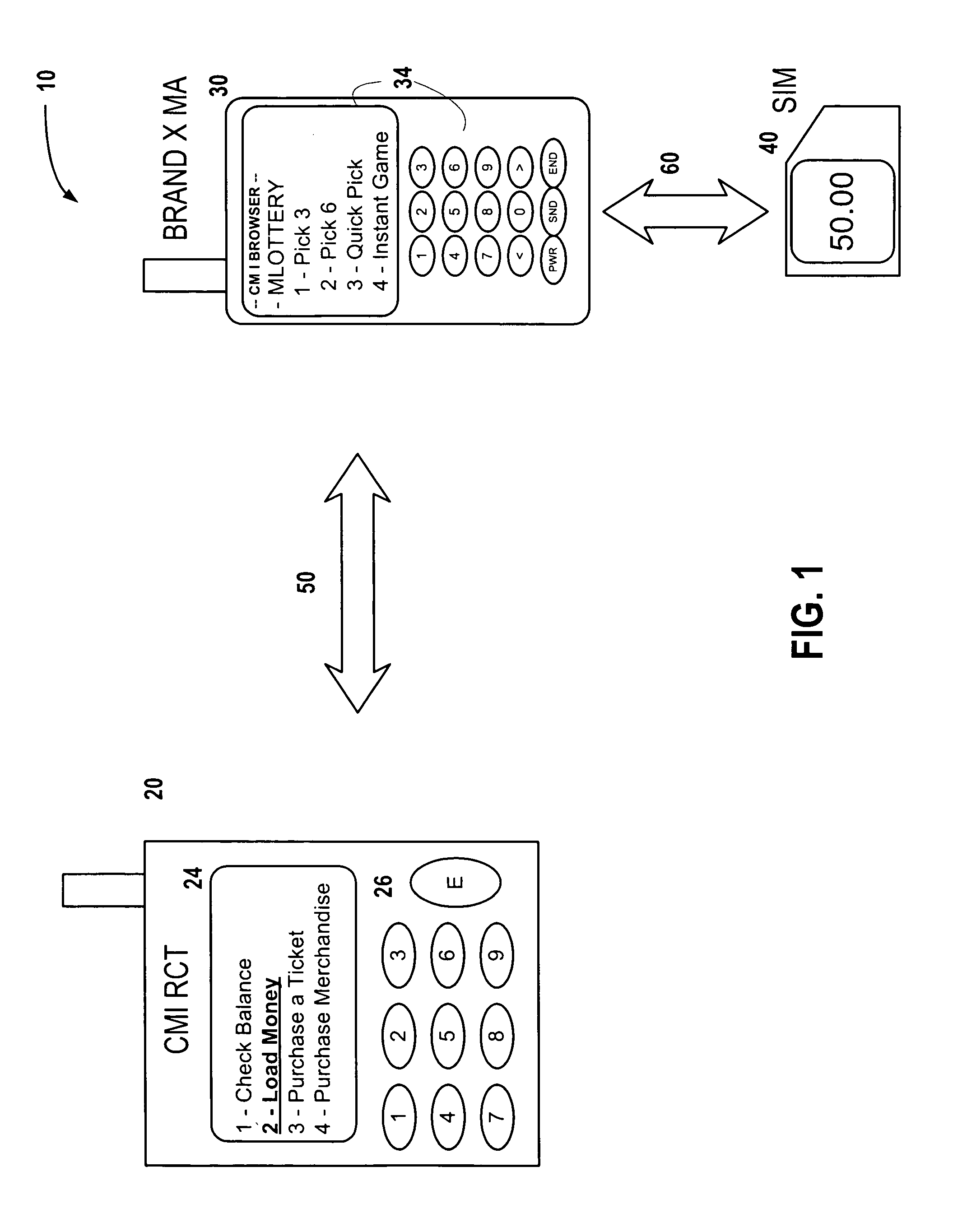

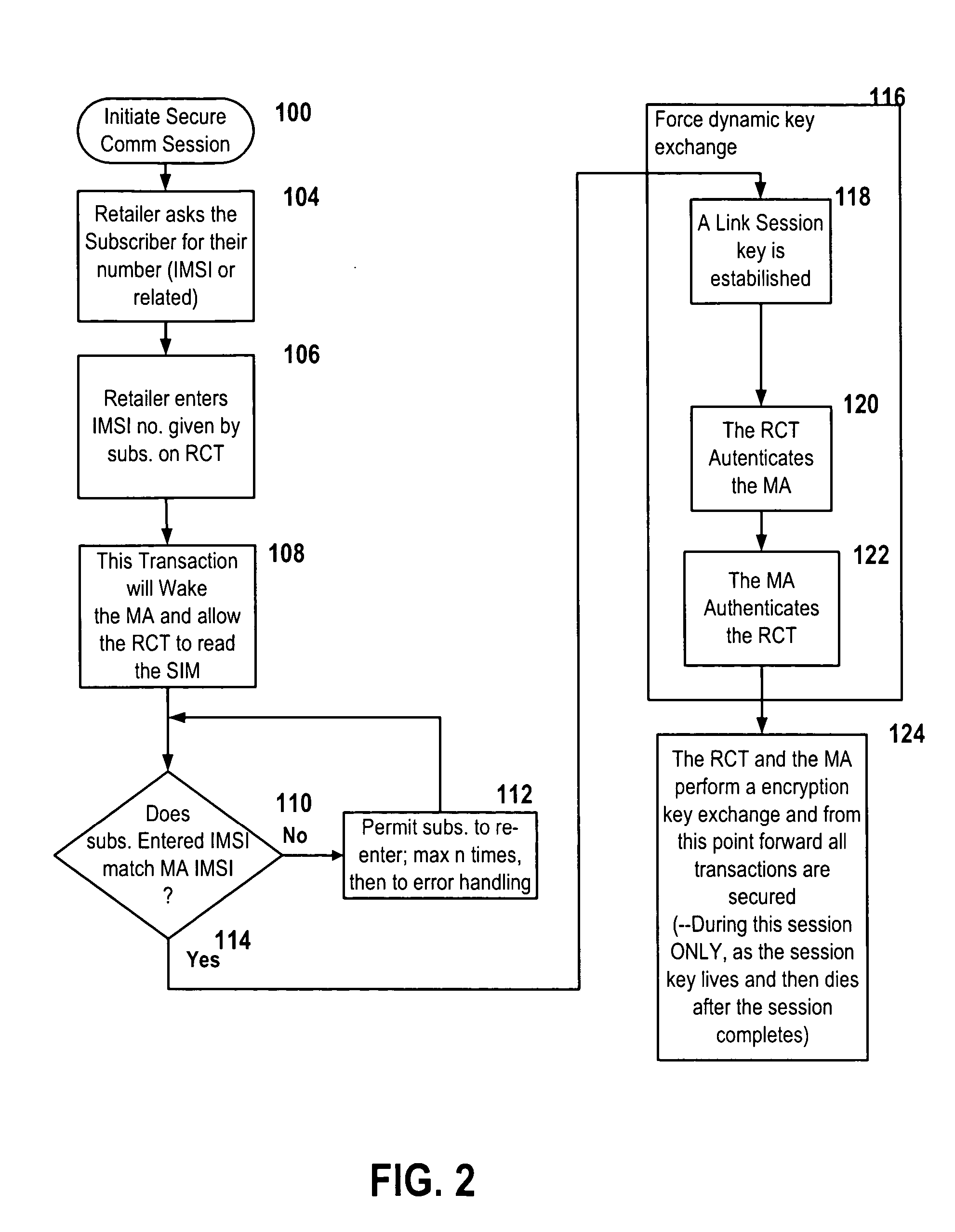

Mobile lottery, gaming and wagering system and method

InactiveUS20050181875A1Credit registering devices actuationTelephonic communicationPagerElectronic cash

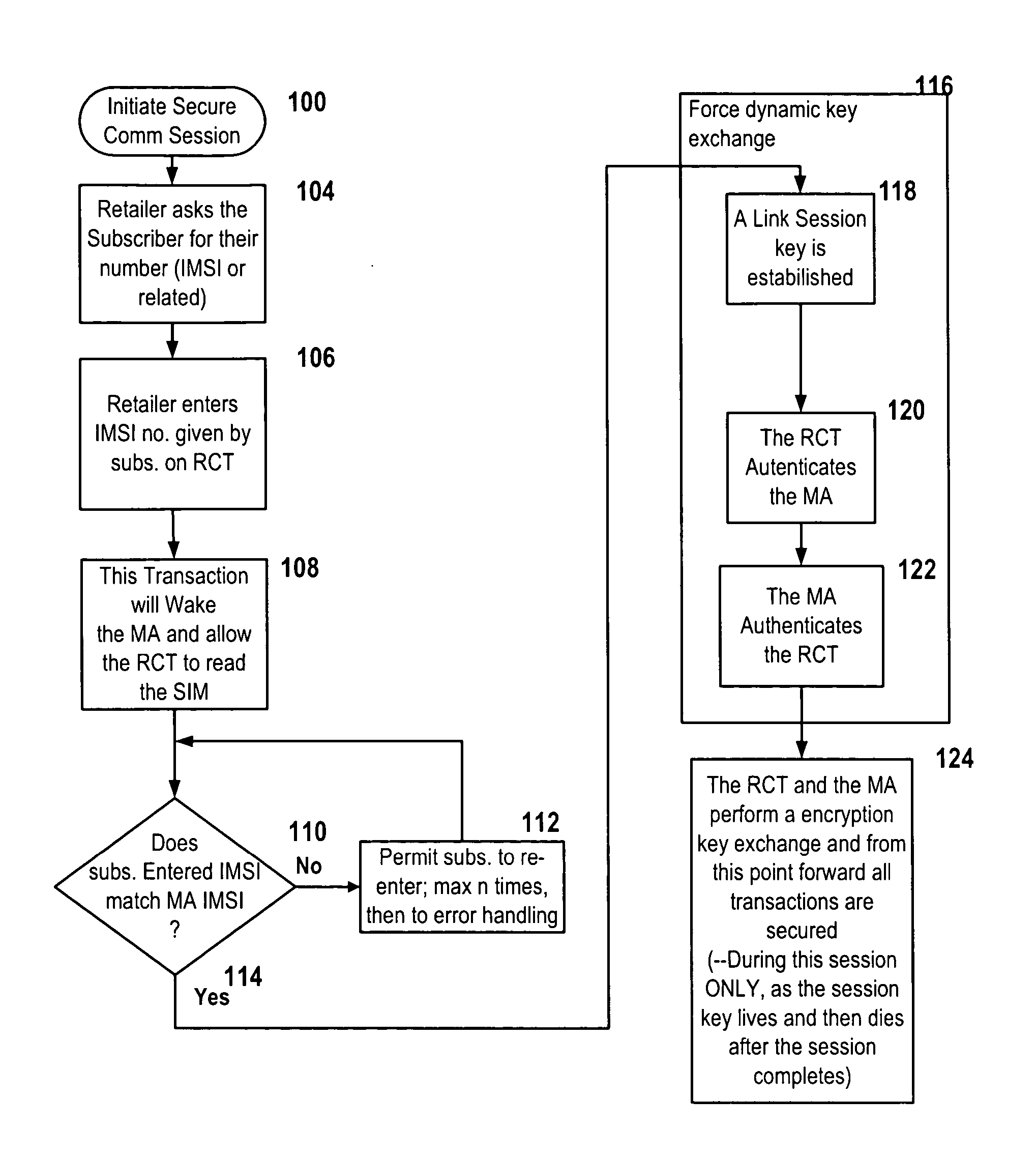

An apparatus or method to allow the secure downloading of an operating system, file management system and or state machine to a Miniature Smart Card (MSC) such as a Subscriber Identity Module (SIM), Universal Subscriber Identity Module (USIM), Removable User Identity Module (RUIM) or Universal Integrated Chip Card (UICC) in a mobile appliance (MA), such as but not limited to a mobile phone, personal digital assistant (PDA), pager or a proprietary device. This would in turn allow an E-purse applet as well as Lottery, Wagering and Gaming applets to be downloaded to the same Miniature Smart Card (MSC) and further allow the downloading of e-cash to be used to remotely play the Lottery, Wagering or Gaming applets as well as make retail purchases.

Owner:COIN MECHANISMS

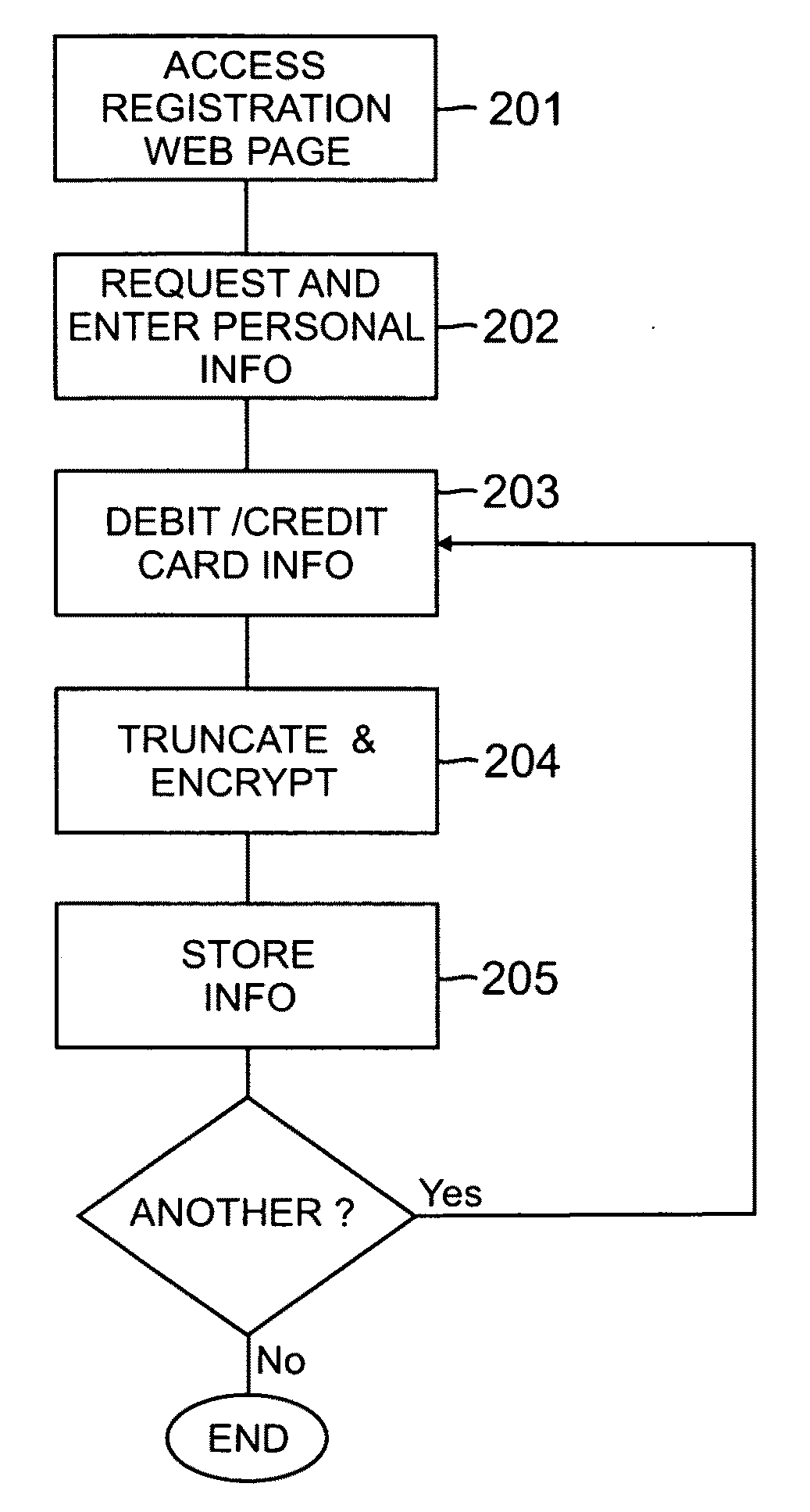

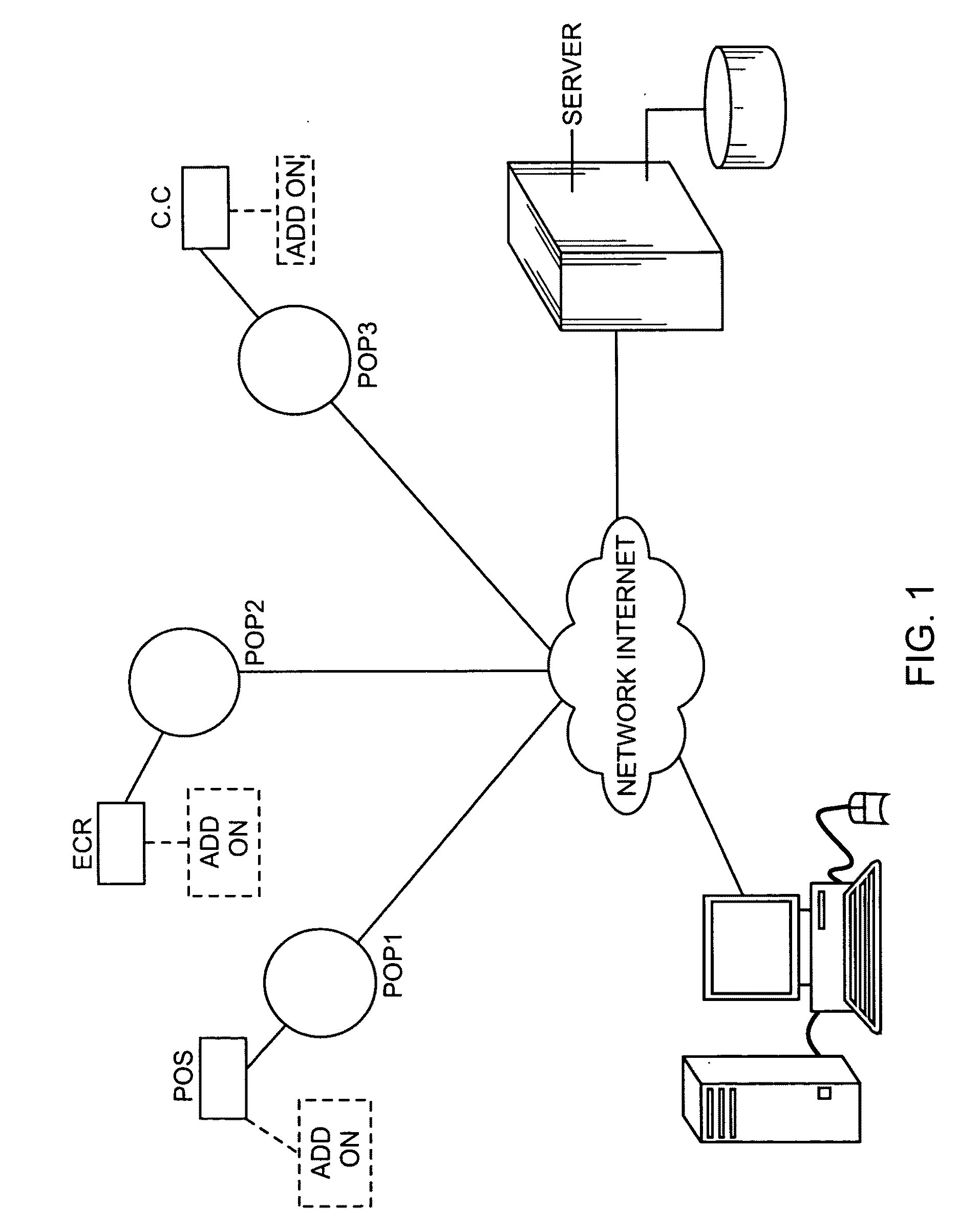

Electronic receipt system and method

InactiveUS20090271322A1Facilitate a product returnFacilitate communicationHand manipulated computer devicesUser identity/authority verificationWeb siteElectronic cash

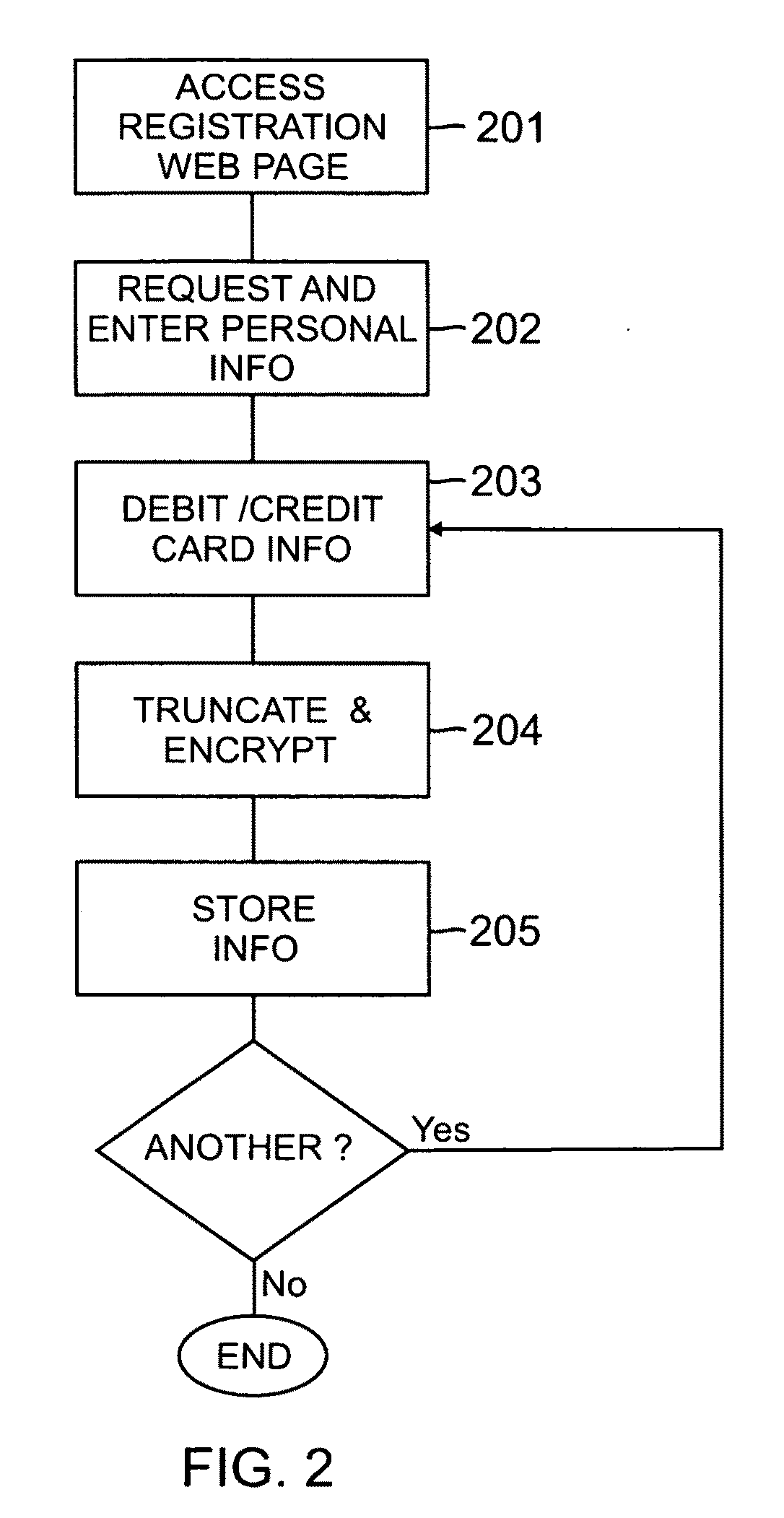

A system and method for auto generating an electronic receipt from virtually any type of public facing business having a live point-of-purchase and utilizing an electronic payment systems, namely, a point-of-sale (POS) system having a credit card terminal and / or an electronic cash registers (ECR). The system includes a software add-on which authenticates and identifies consumers at the POP using a pre-registered credit / debit card, deactivates normal receipt printing functionality, captures electronic receipt information and transmits this information to a membership or subscriber based Internet web-site, where consumers may then view and manage the information. The system can be used to automate a product return and / or generate and transmit a gift receipt. The system further includes a membership or provider based Internet website for merchants to view and manage information related to previous customers, from which merchants may distribute coupons and / or advertisements to these consumers.

Owner:CYNDIGO CORP

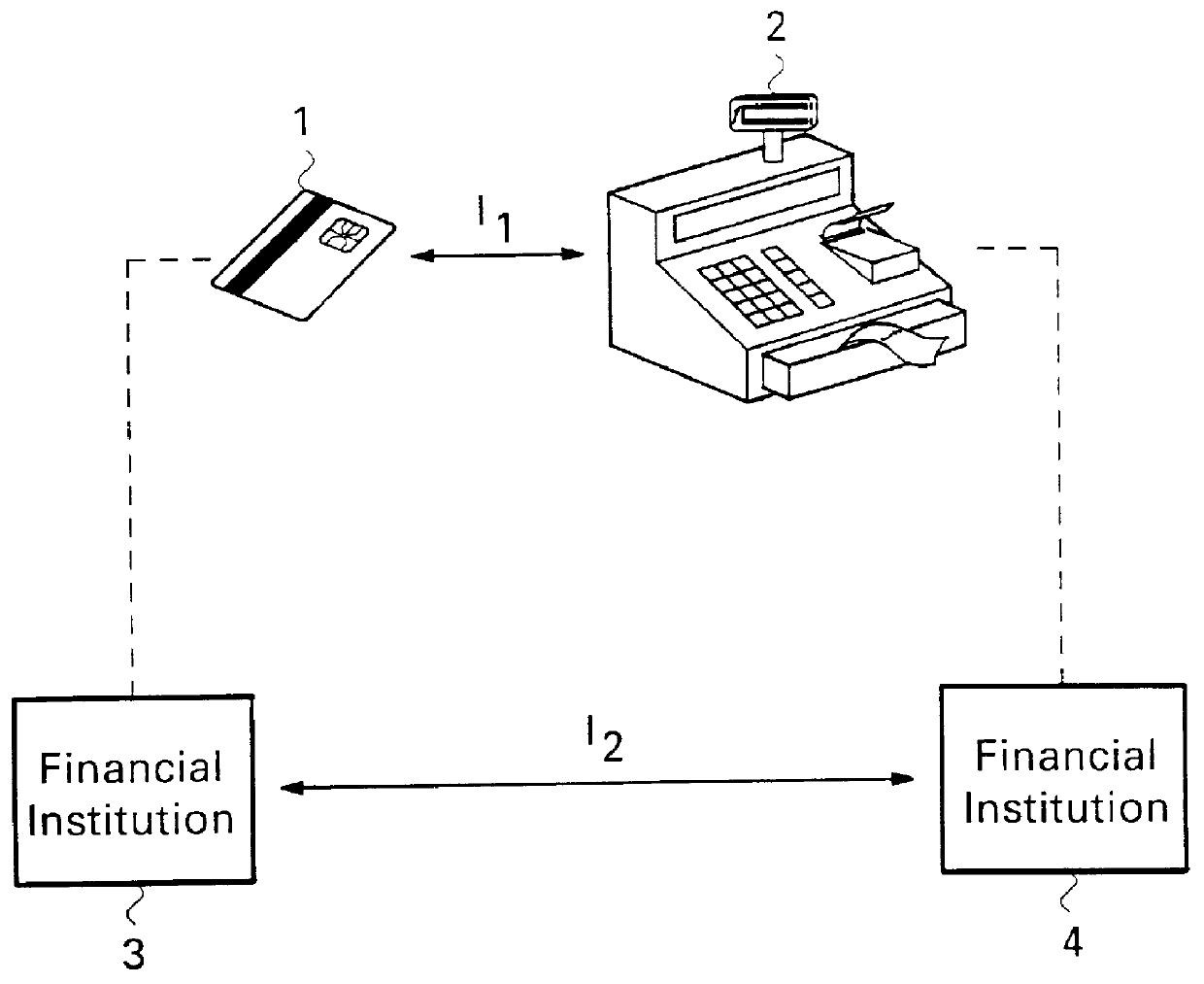

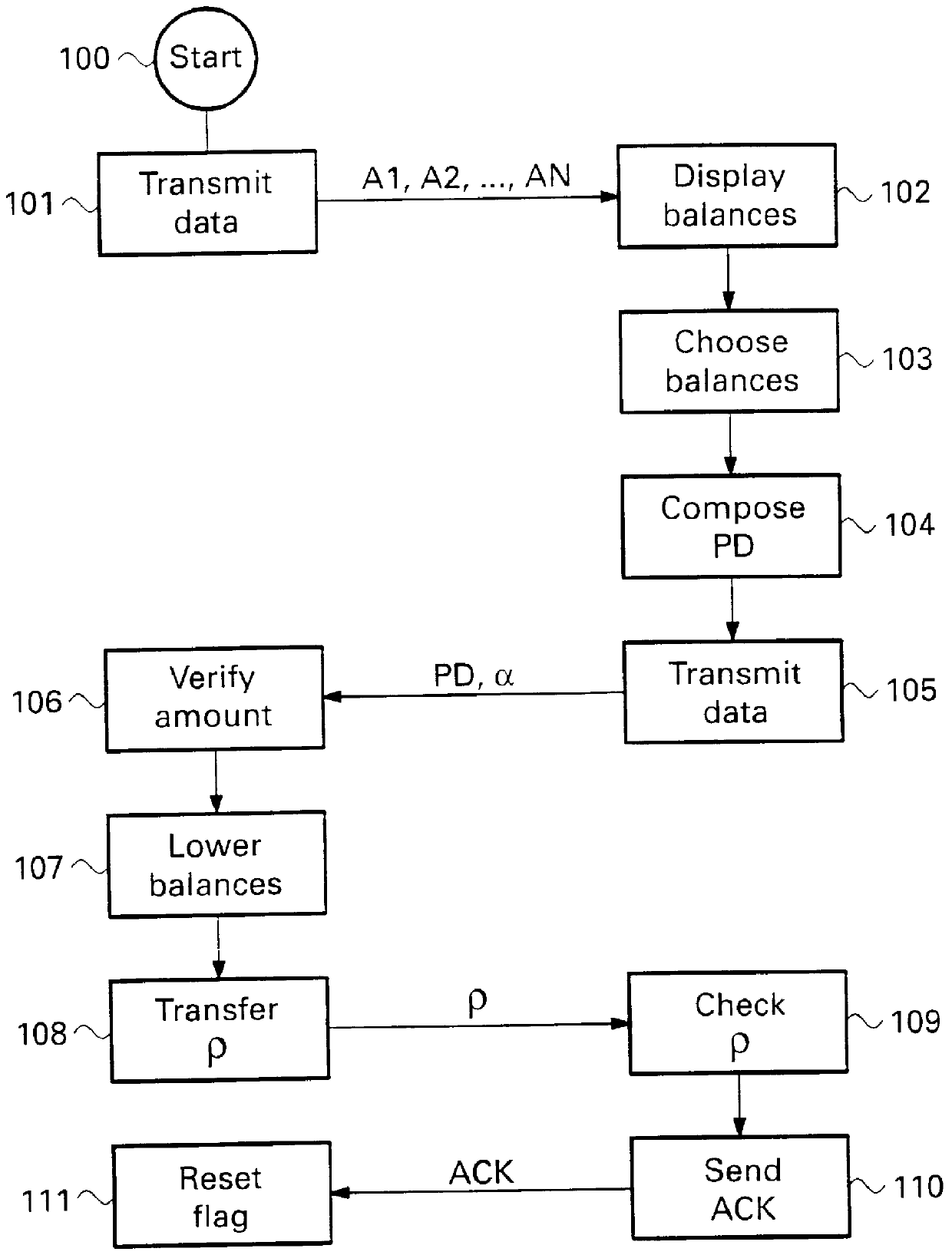

Electronic payment method and system having several calculation units and electronic payment devices

A payment system for use with electronic payment devices. Electronic payment cards (e.g. "Smart Cards"), may be used with one or more payment stations (e.g. electronic cash registers). The payment stations are designed for receiving, during a payment transaction, a monetary value by crediting, in the payment station, a first value, and debiting, in the payment means, a second value corresponding to the first value. The first and second values may be expressed in different calculation units, such as currencies of different countries. The system furthermore offers a payment device for application in such a system, and a method for effecting a payment transaction with an electronic payment means.

Owner:KONINK KPN NV

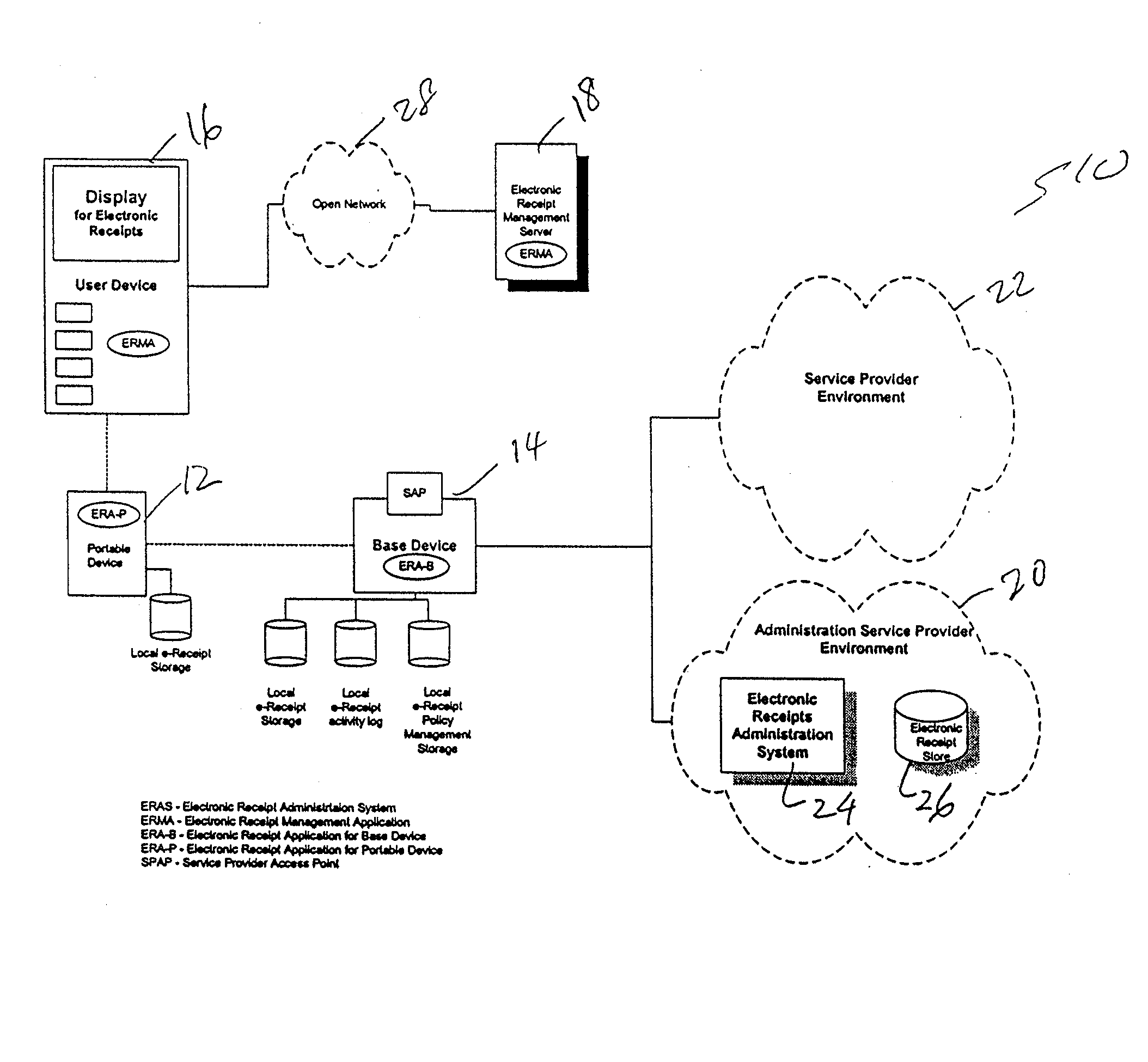

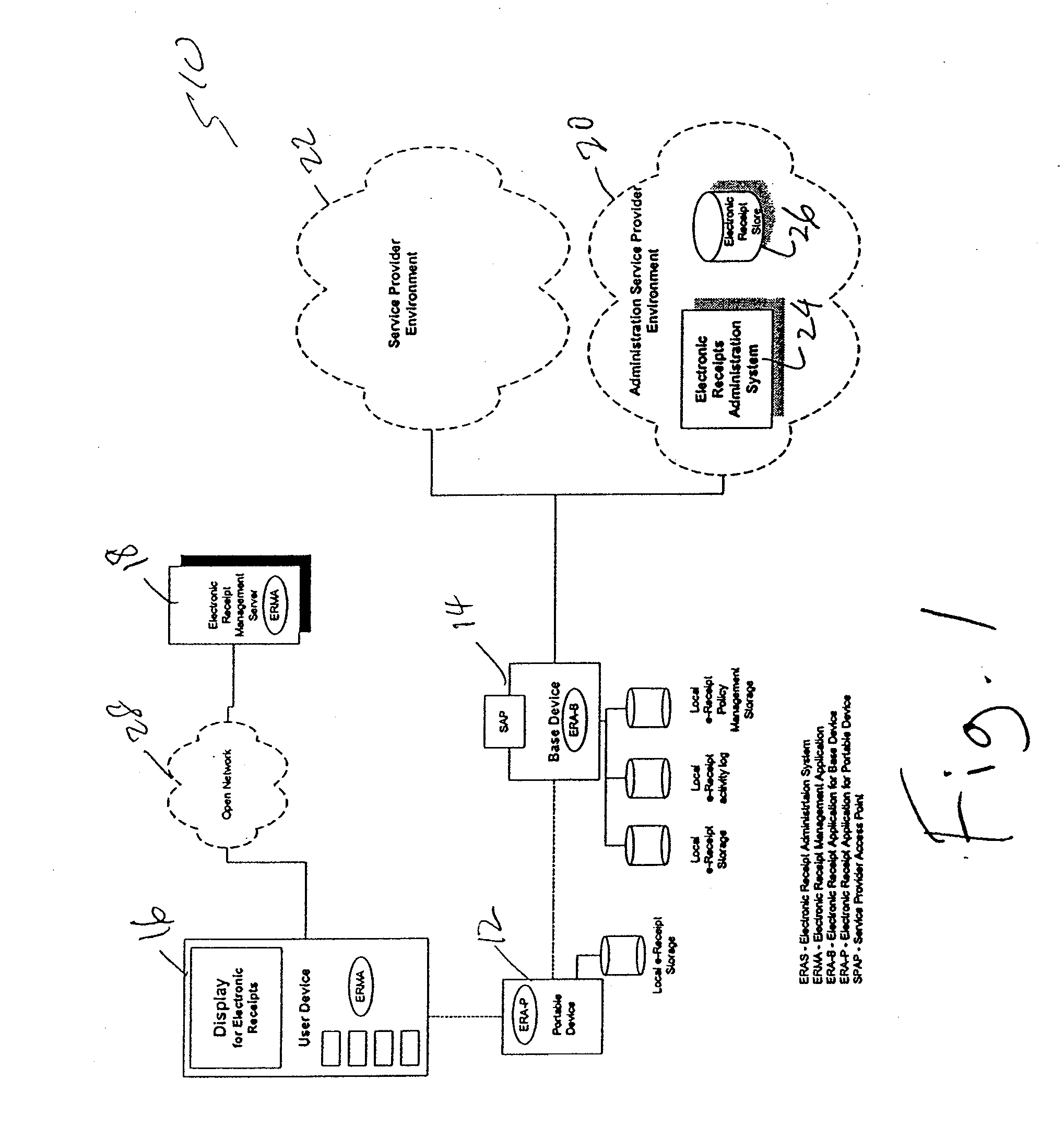

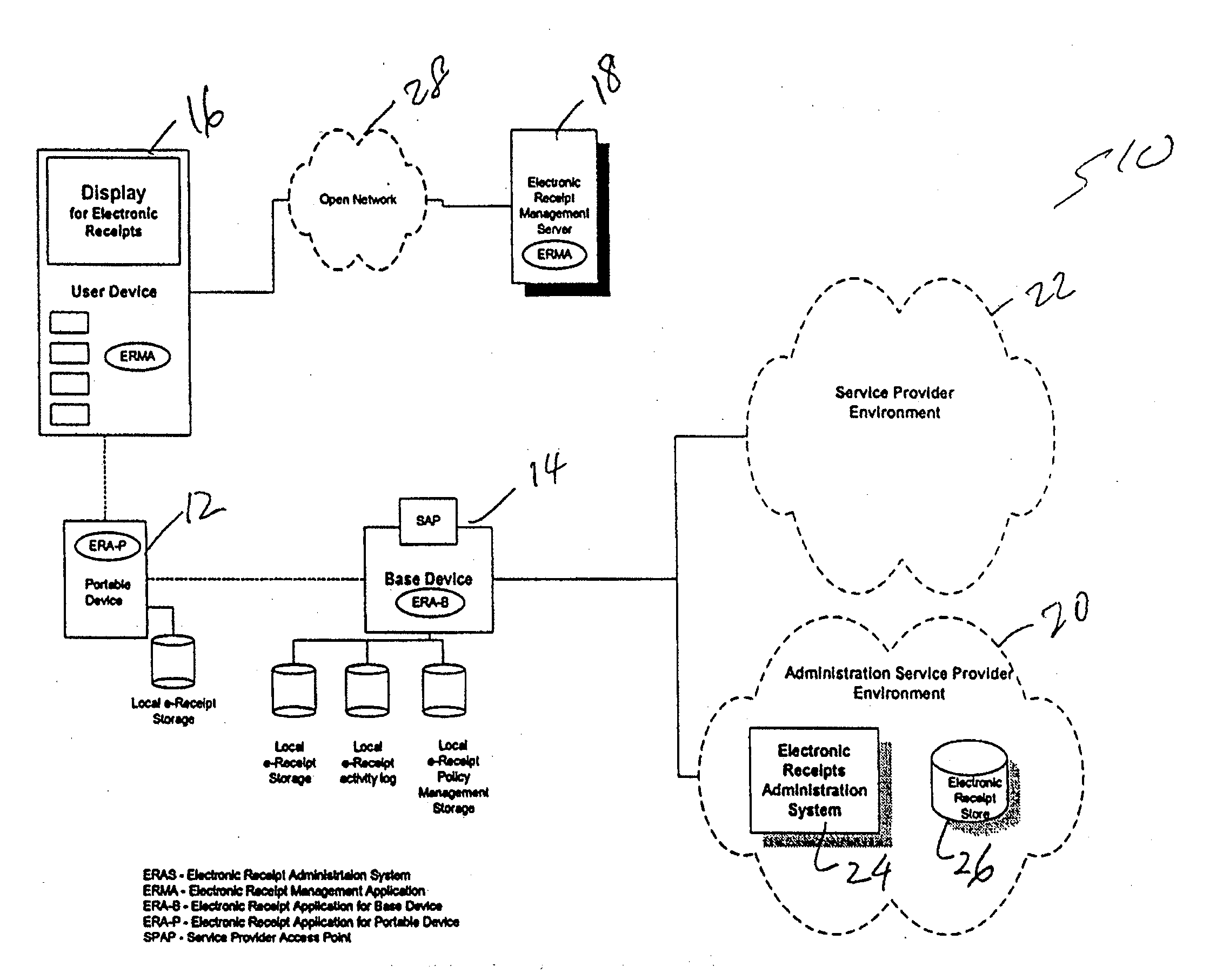

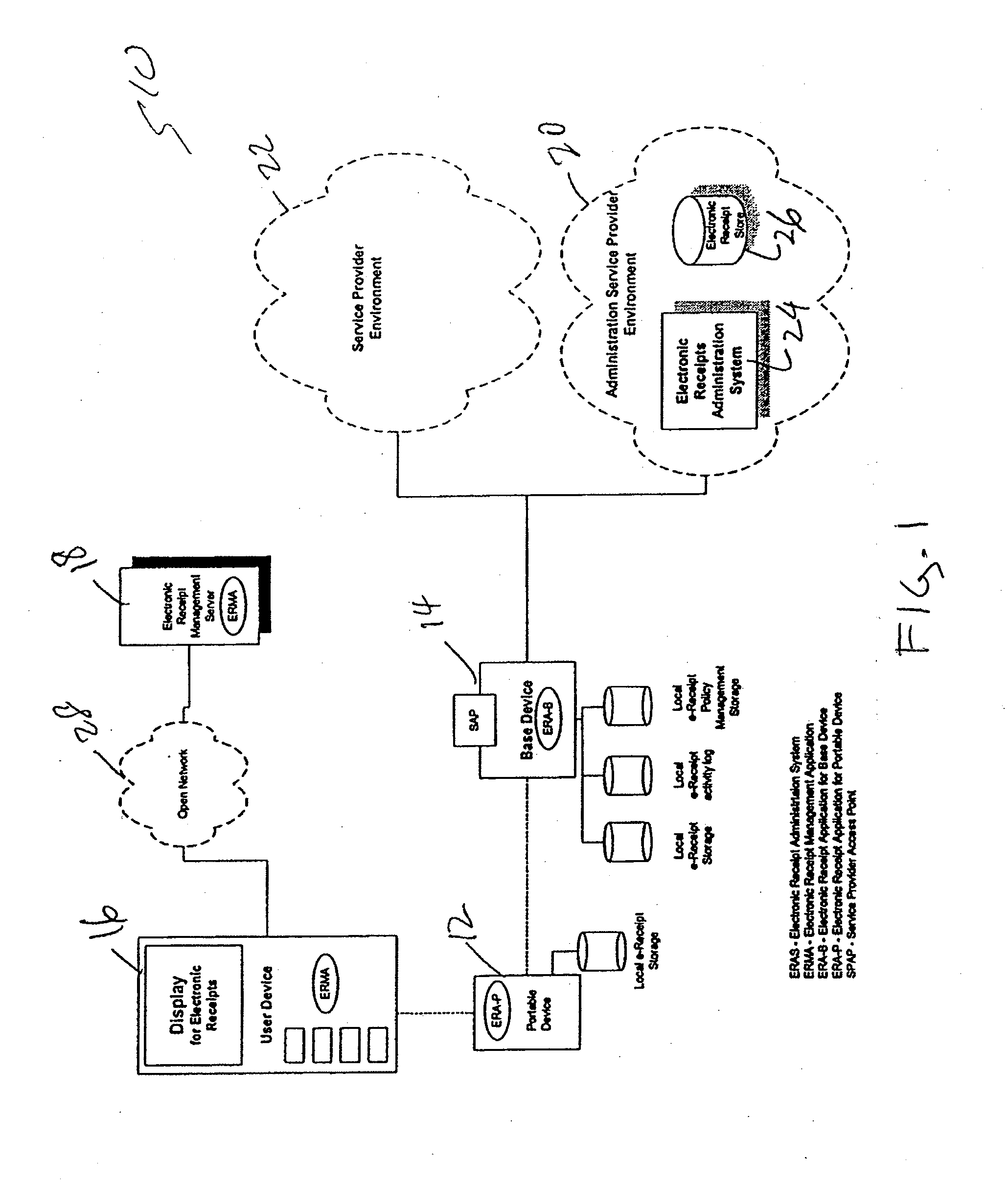

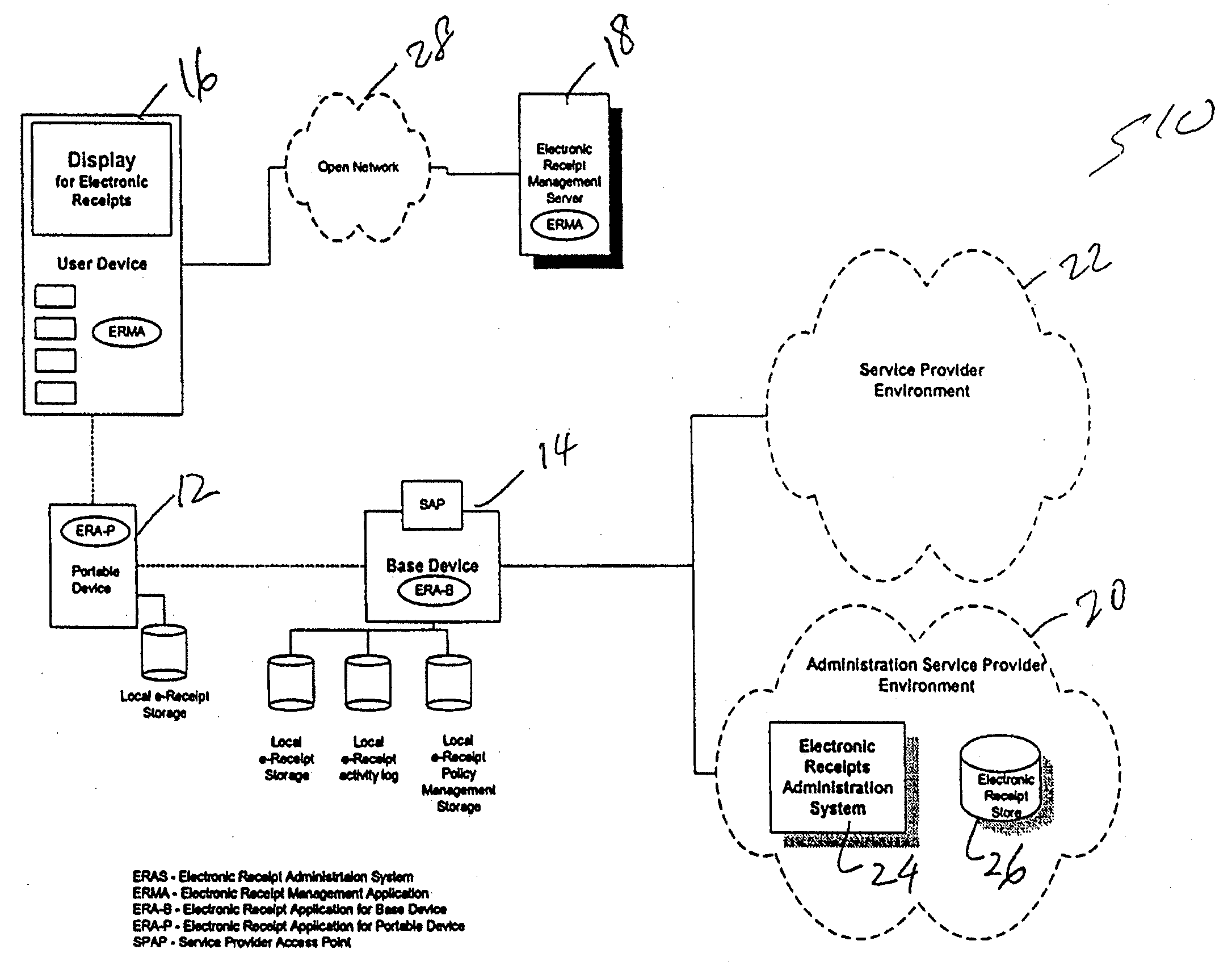

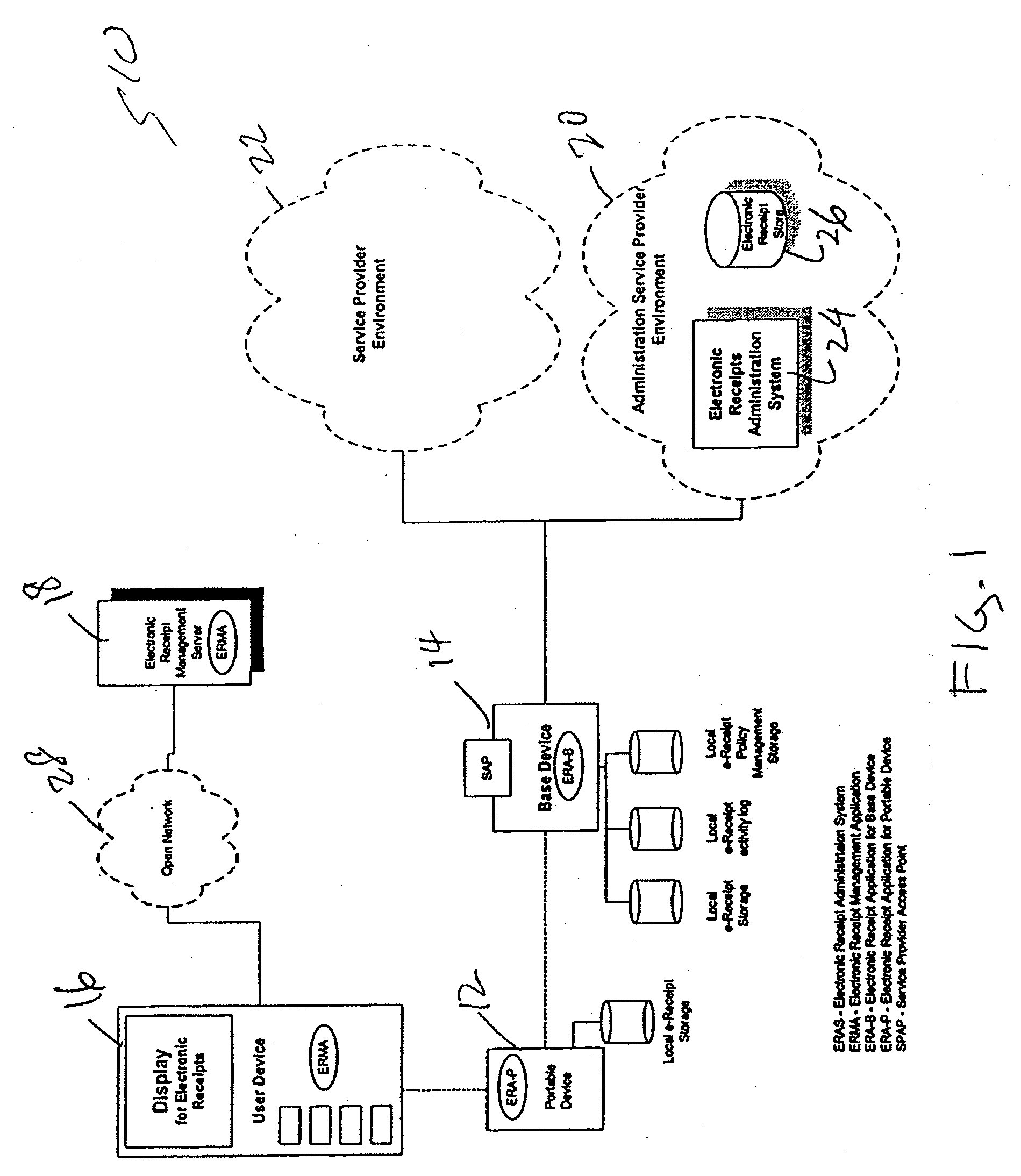

Method and Server for Management of Electronic Receipts

A system for managing electronic receipts is provided. According to one aspect, the system includes a portable device, a base device, a user device and an electronic receipts administration system. The electronic receipts administration system provides the base device with the appropriate data to allow the base device to generate, store and manage electronic receipts accordingly. A user uses the portable device to conduct a transaction with the base device. The base device uses a variety of information to generate an electronic receipt for the transaction. Such information includes, for example, information stored on the portable device, information stored locally on the base device and information stored on another device such as an electronic cash register. The electronic receipt is then stored on the portable device. The user device allows the user to subsequently retrieve the electronic receipt for management purposes.

Owner:VISA USA INC (US)

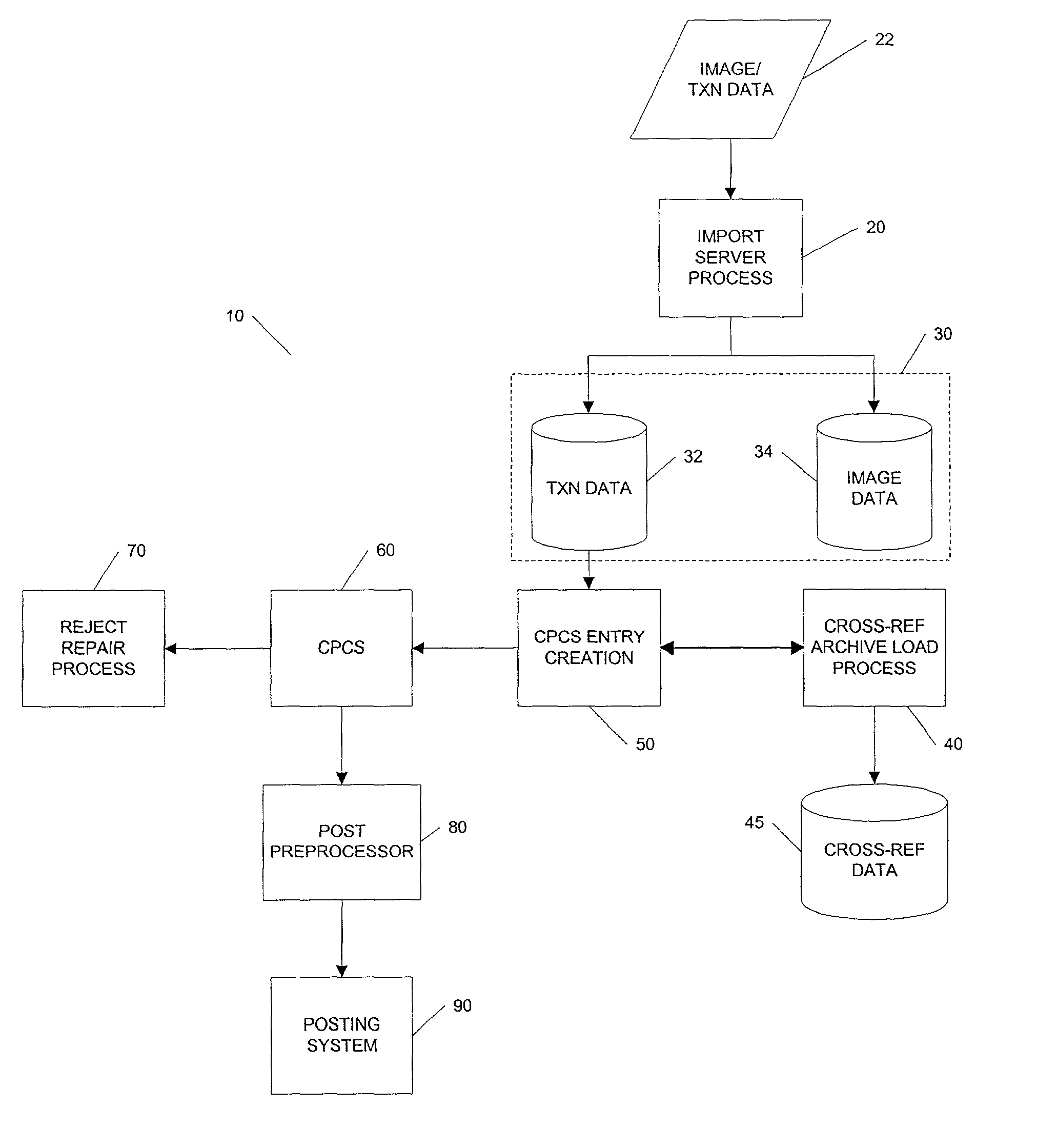

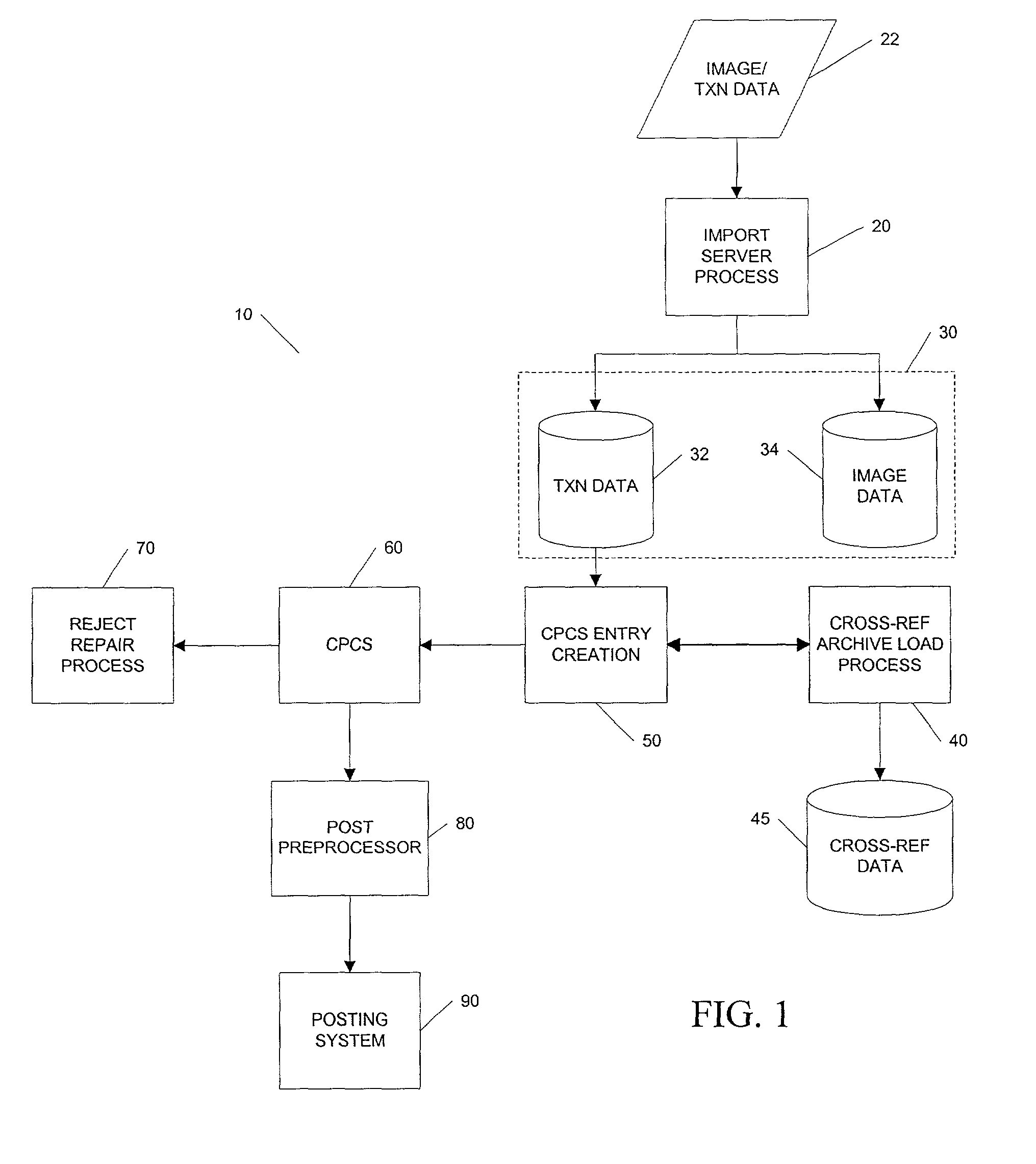

System and method for image based electronic check presentment

ActiveUS7996312B1Linkage integrityEnsure integrityComplete banking machinesFinanceElectronic cashComputer module

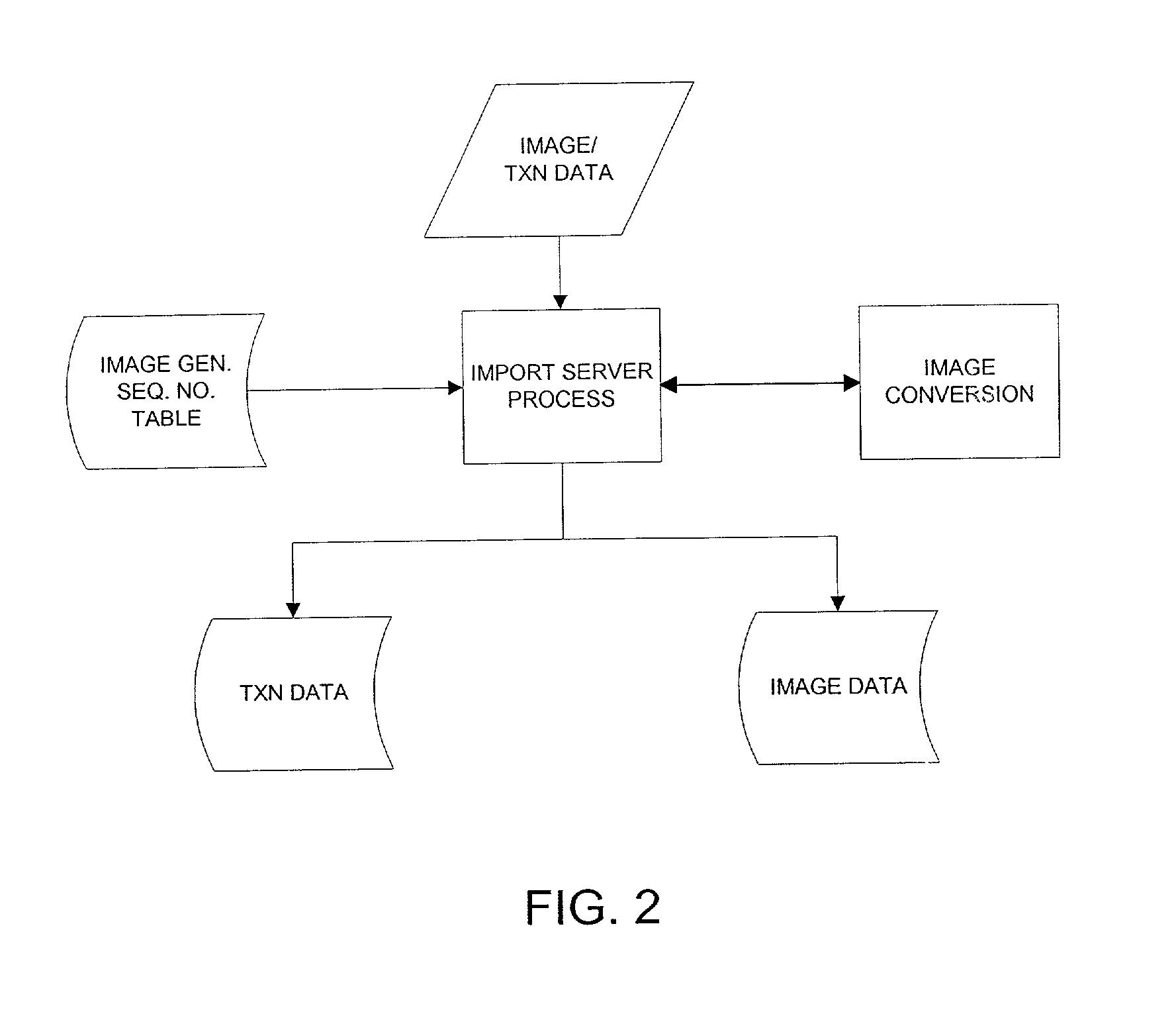

A method and system for processing electronic check presentment (ECP) data and check image data, where the check image data is transmitted electronically, either with the ECP data or separately. The ECP data has associated ECP sequence numbers assigned in connection with the preparation of an electronic cash letter (ECL). The check image data has associated image sequence numbers assigned to the image file that is transmitted with or following the ECL. A source key and an image key are defined for each item in the ECP data and the image data. An electronic check presentment (EIP) sequence number generated at the receiving financial institution, associates each presented electronic item with the ECP sequence number and image sequence number. System components include a transaction and image import server, an entry creation module, a cross-reference archive load module, a reject repair module, a post preprocessor module and a posting module. These components enable transaction and image data to be imported to a host processing system, formatted, converted between standard image formats, repaired on the date received, archived and posted to customer accounts in a check truncation environment.

Owner:WELLS FARGO BANK NA

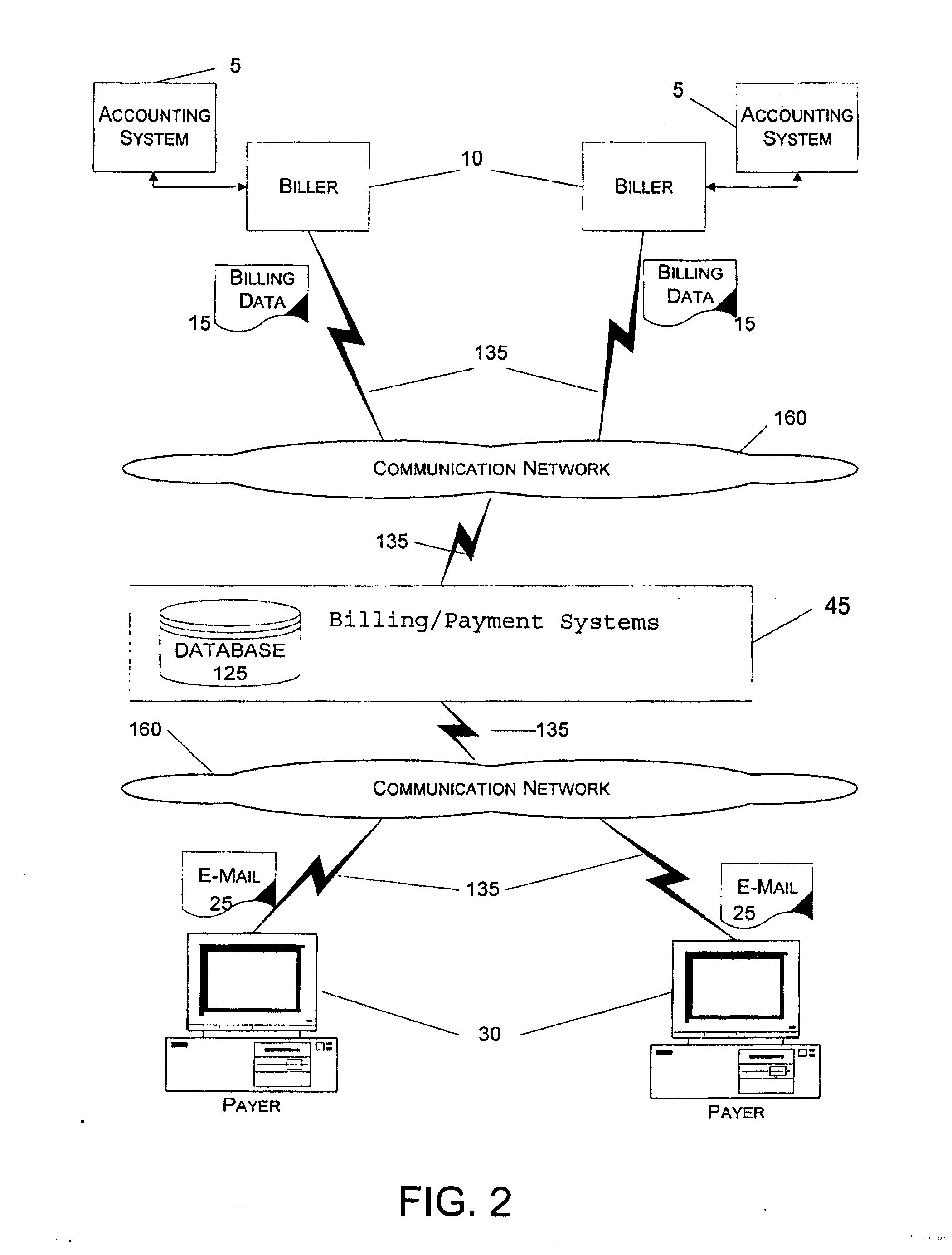

On-line payment system

InactiveUS7177830B2Easy transferEasy to optimizeSpecial service provision for substationMetering/charging/biilling arrangementsBank accountElectronic cash

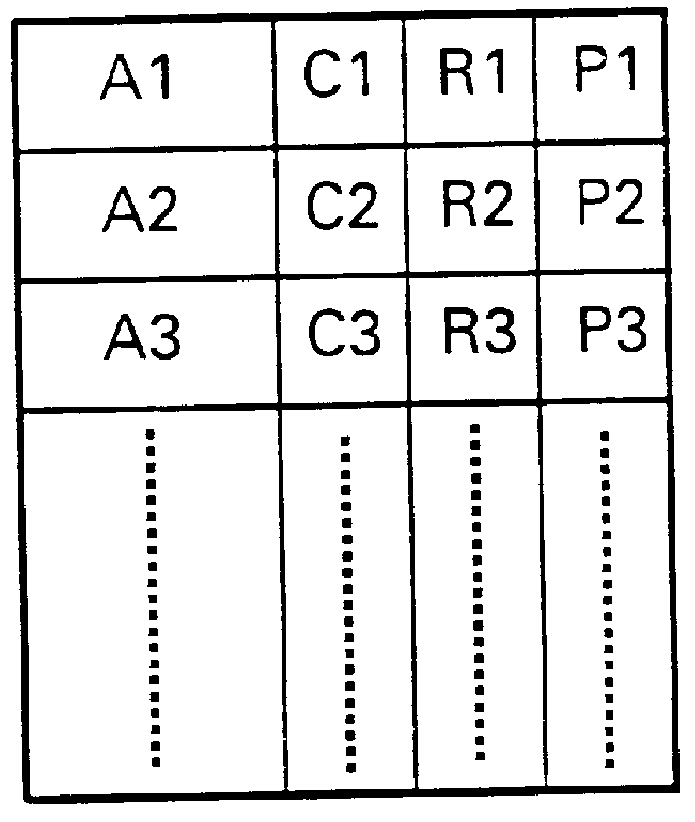

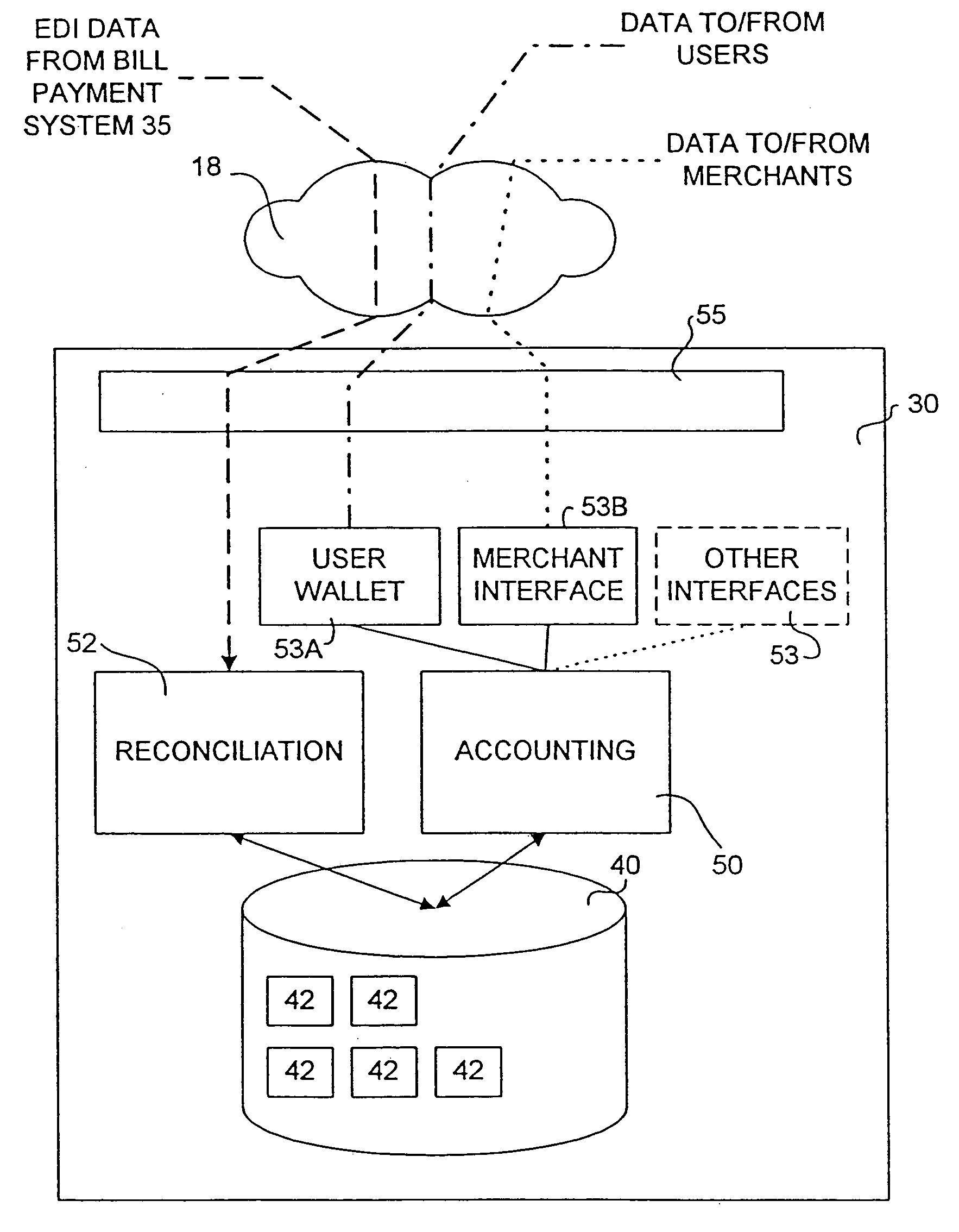

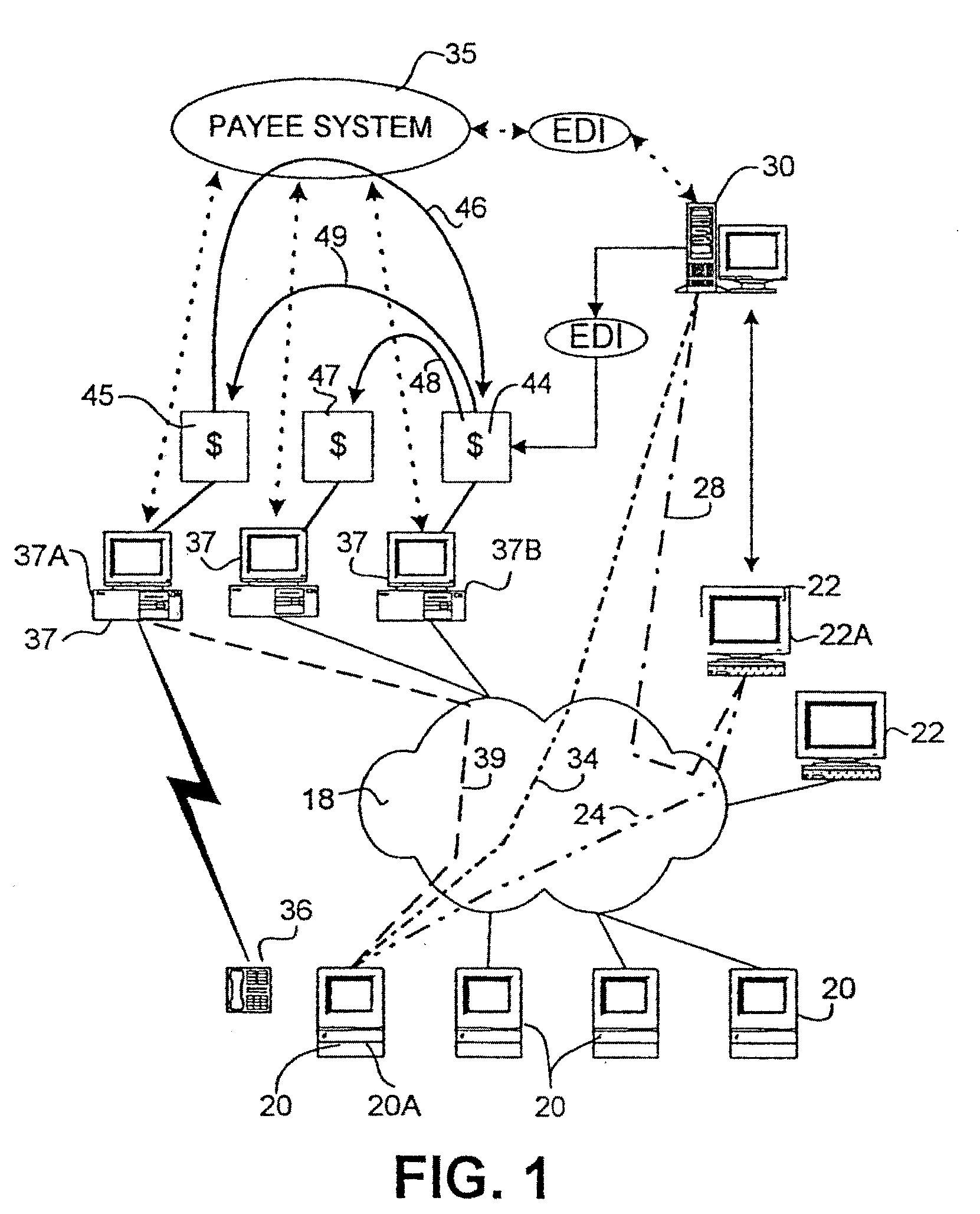

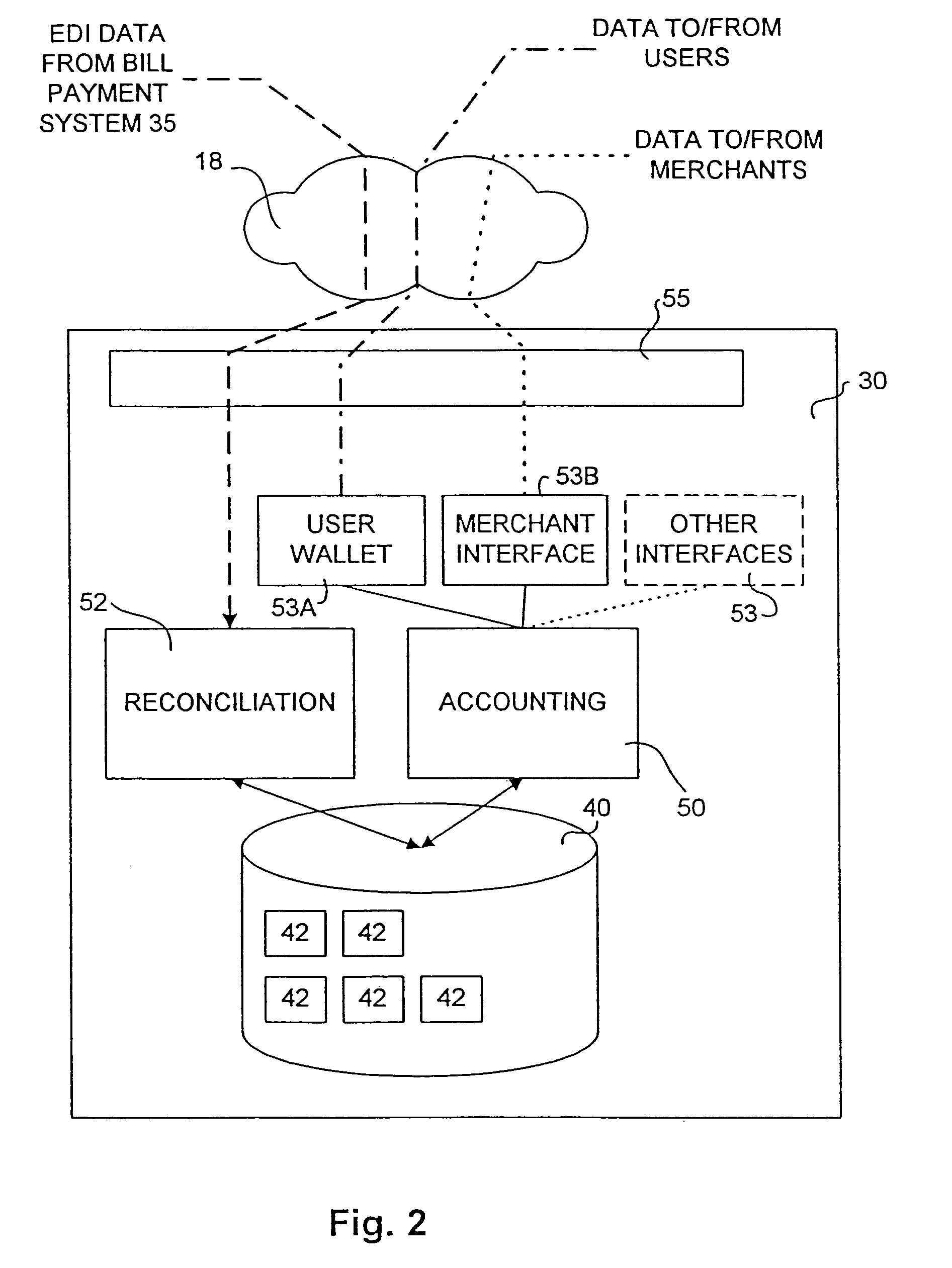

An on-line payment system comprises a computer system which can maintain accounts in a database for a plurality of users. The system is enrolled as a payee in a bill payment system so that users can transfer funds from their bank accounts to electronic cash accounts in the system by making a bill payment to the system. The bill payment is deposited in a bank account maintained by the operator of the system. The system includes a double-entry, net zero accounting system which ensures that electronic cash in the accounts on the system is supported by actual cash on deposit in the bank account of the system. Users can spend electronic cash before the system actually receives funds via the bill payment system. Electronic cash spent during this period is marked uncleared by the system. The system includes reconciliation software which matches payments received to uncleared electronic cash and marks the electronic cash as being cleared. After the electronic cash has been cleared it can be converted into regular cash. The electronic cash of the system is recyclable, anonymous, and secure.

Owner:PAYPAL INC

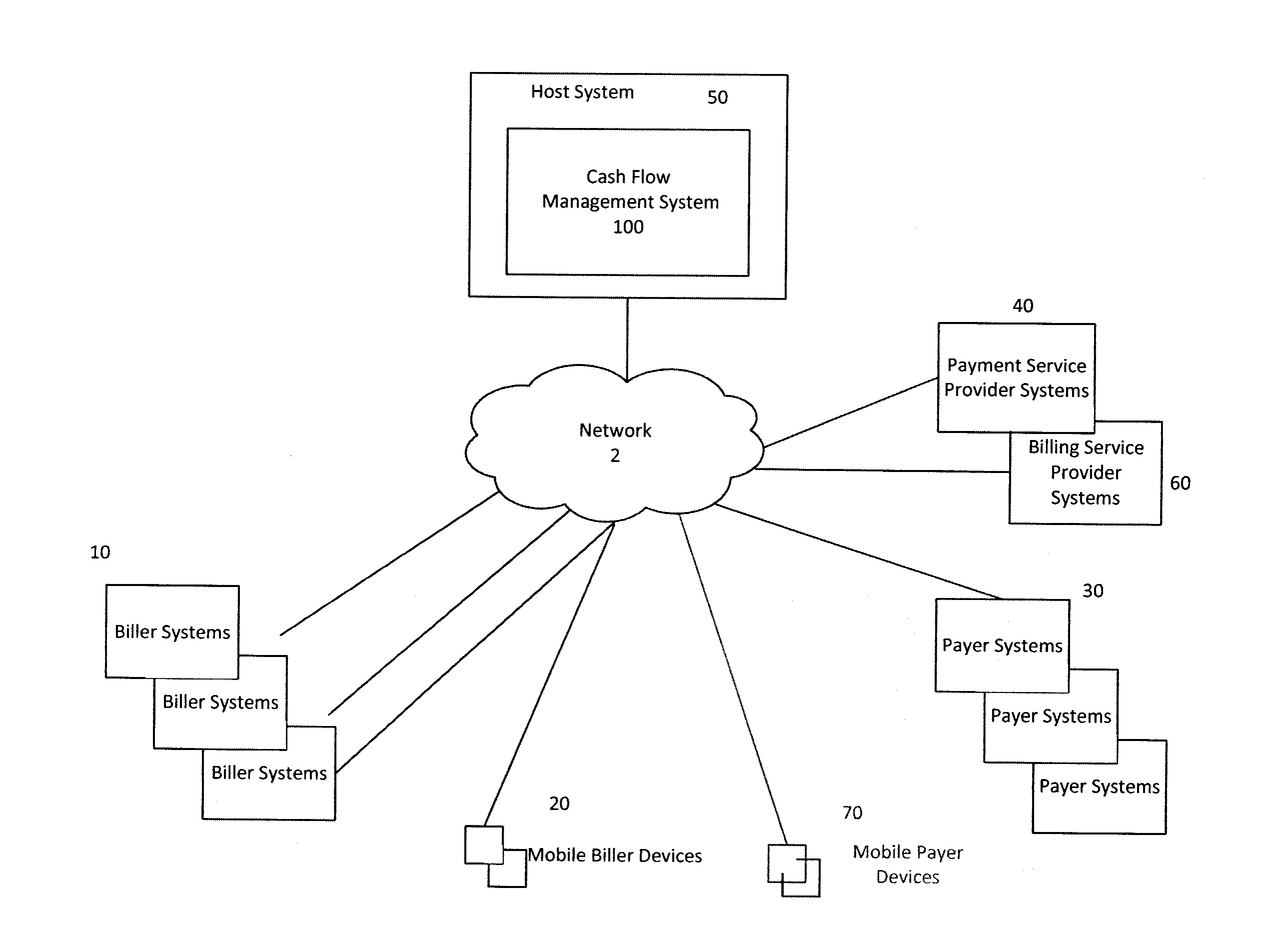

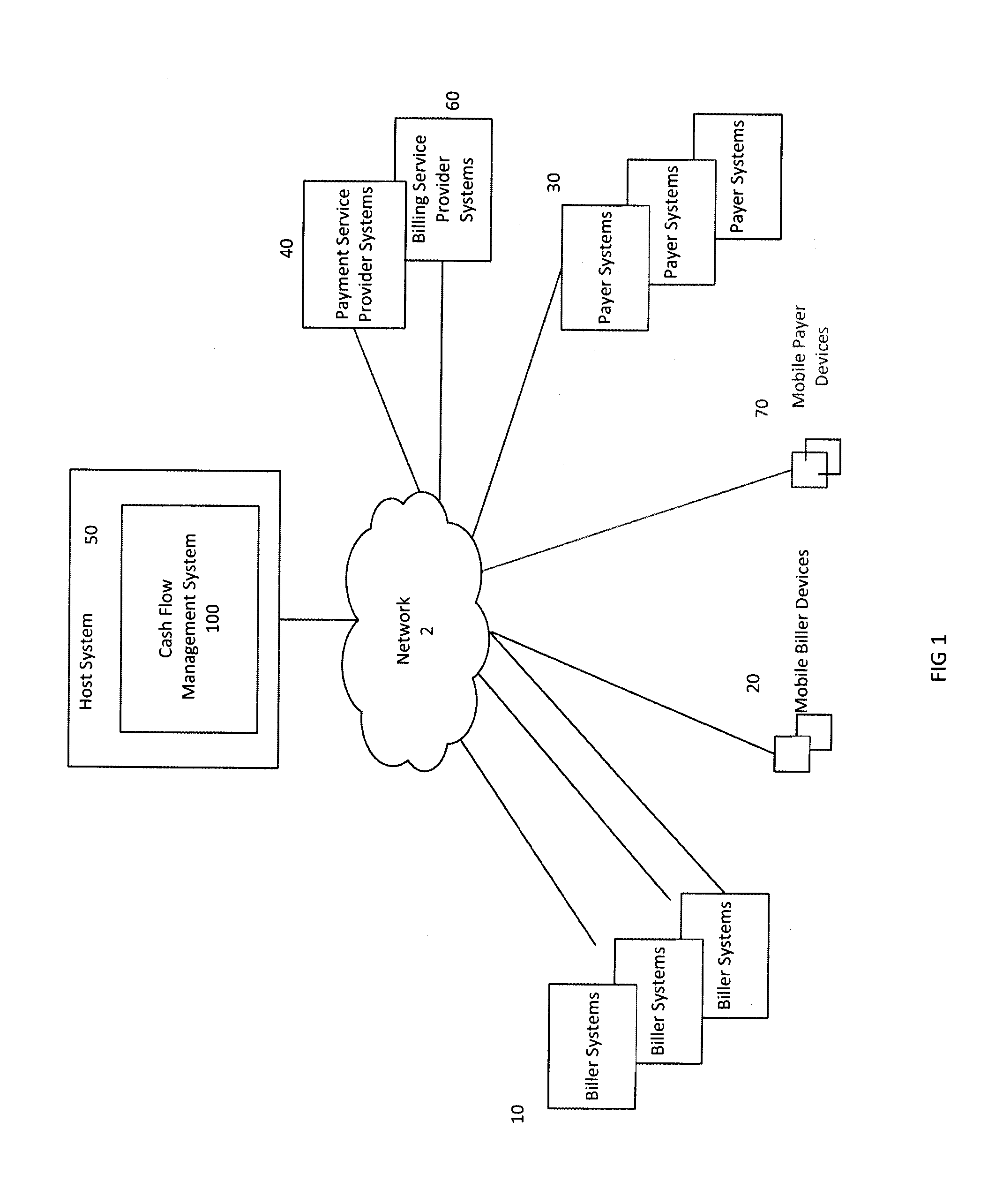

Integrated Electronic Cash Flow Management System and Method

ActiveUS20140222669A1Facilitating bill paymentFacilitating reconciliationFinancePayment architectureCommunication interfaceInvoice

A cash flow management system is provided within a host system for facilitating cash flow management for businesses. The cash flow management system includes an electronic billing and invoicing computing system enabling generation and transmission of electronic bills based on business invoices and for displaying the generated bills for payment and an integrated receivables and reconciliation system receiving notification of received payments and for matching received payments with the generated invoices. The system additionally includes a communication interface for allowing the cash flow management system to communicate with multiple financial management systems accessible to the host enterprise, the systems including at least an accounting system, the integrated receivables management system receiving information from the financial management systems within the host system to facilitate management of cash flow for the businesses using the cash flow management system for electronic billing.

Owner:JPMORGAN CHASE BANK NA

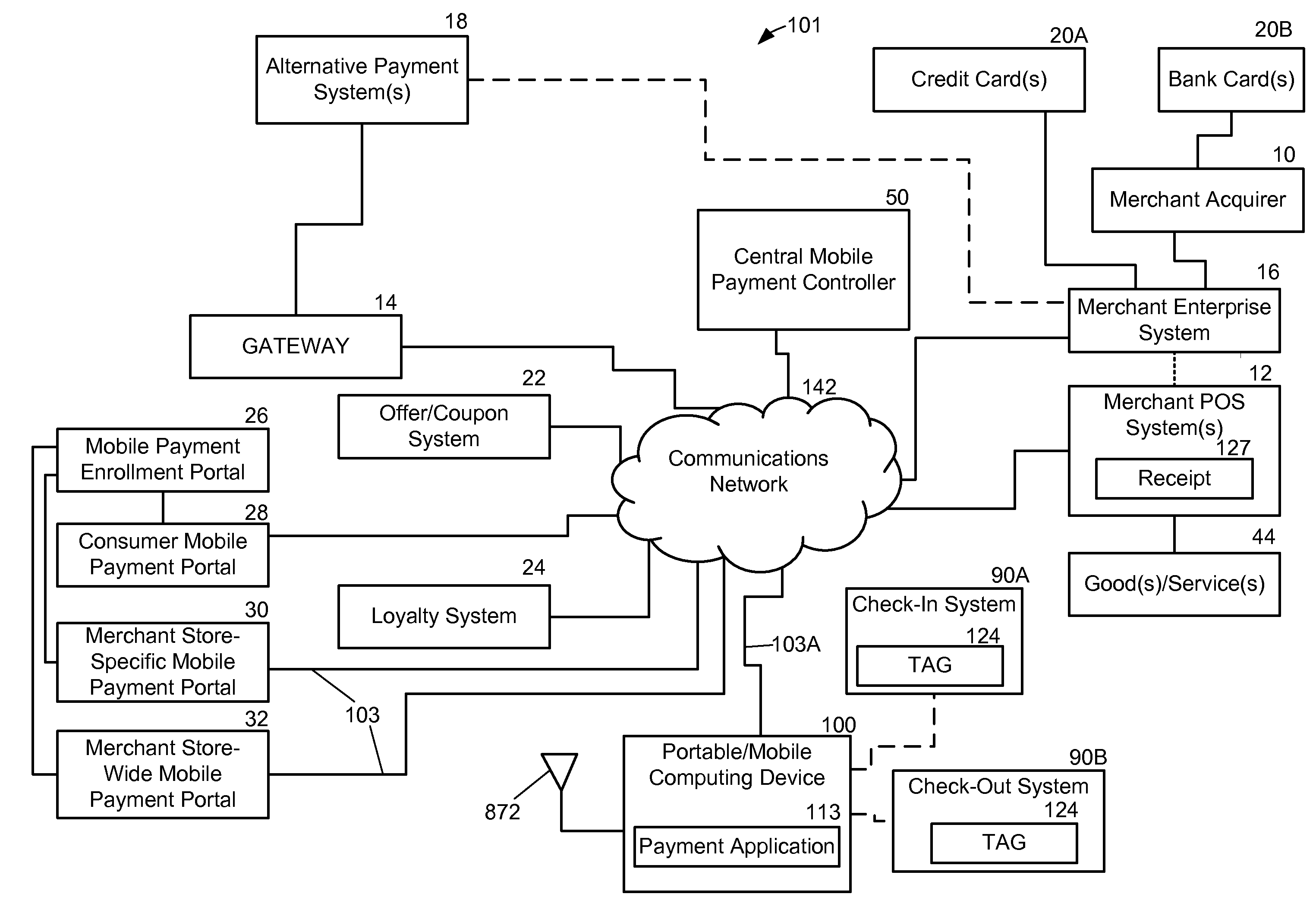

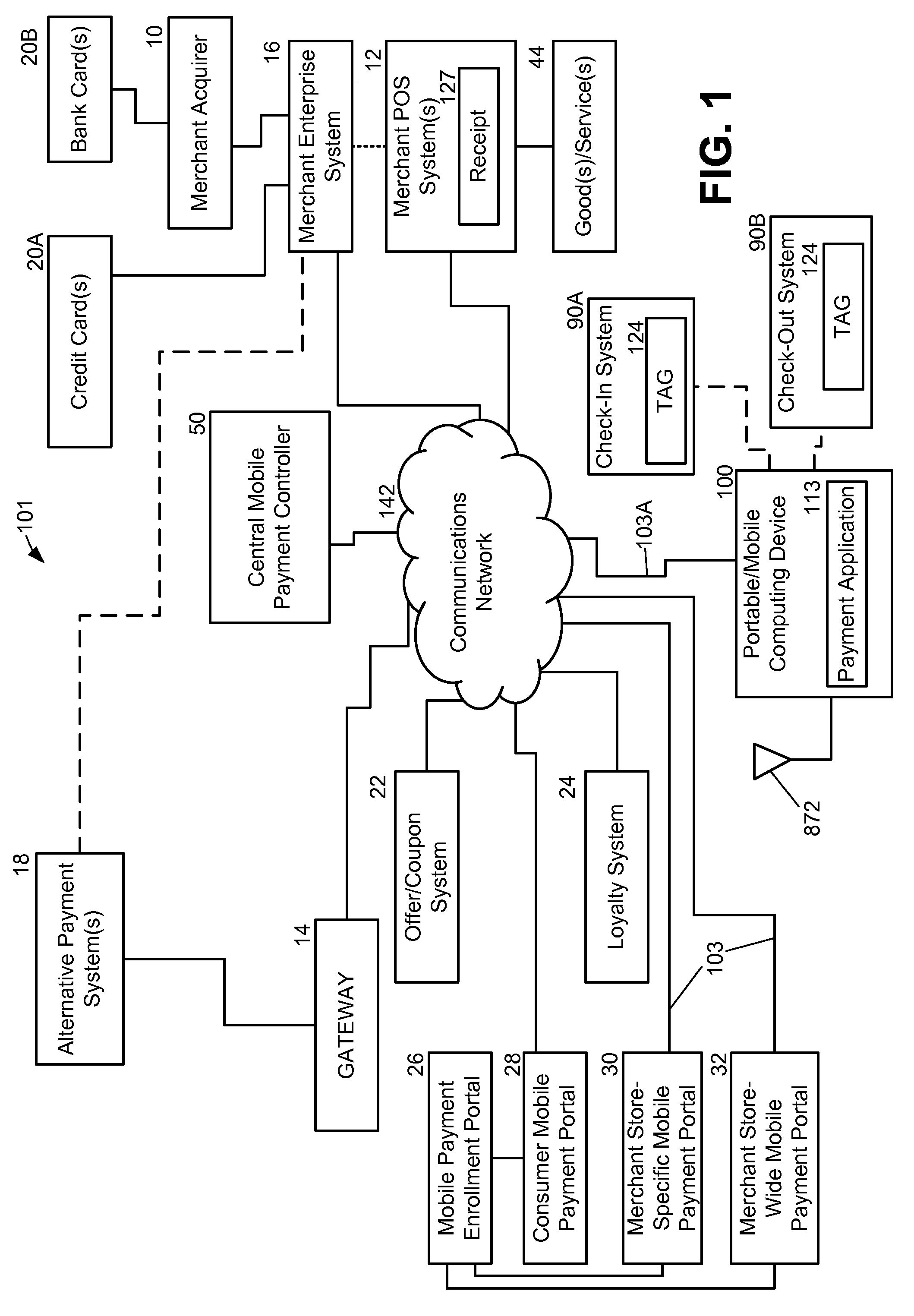

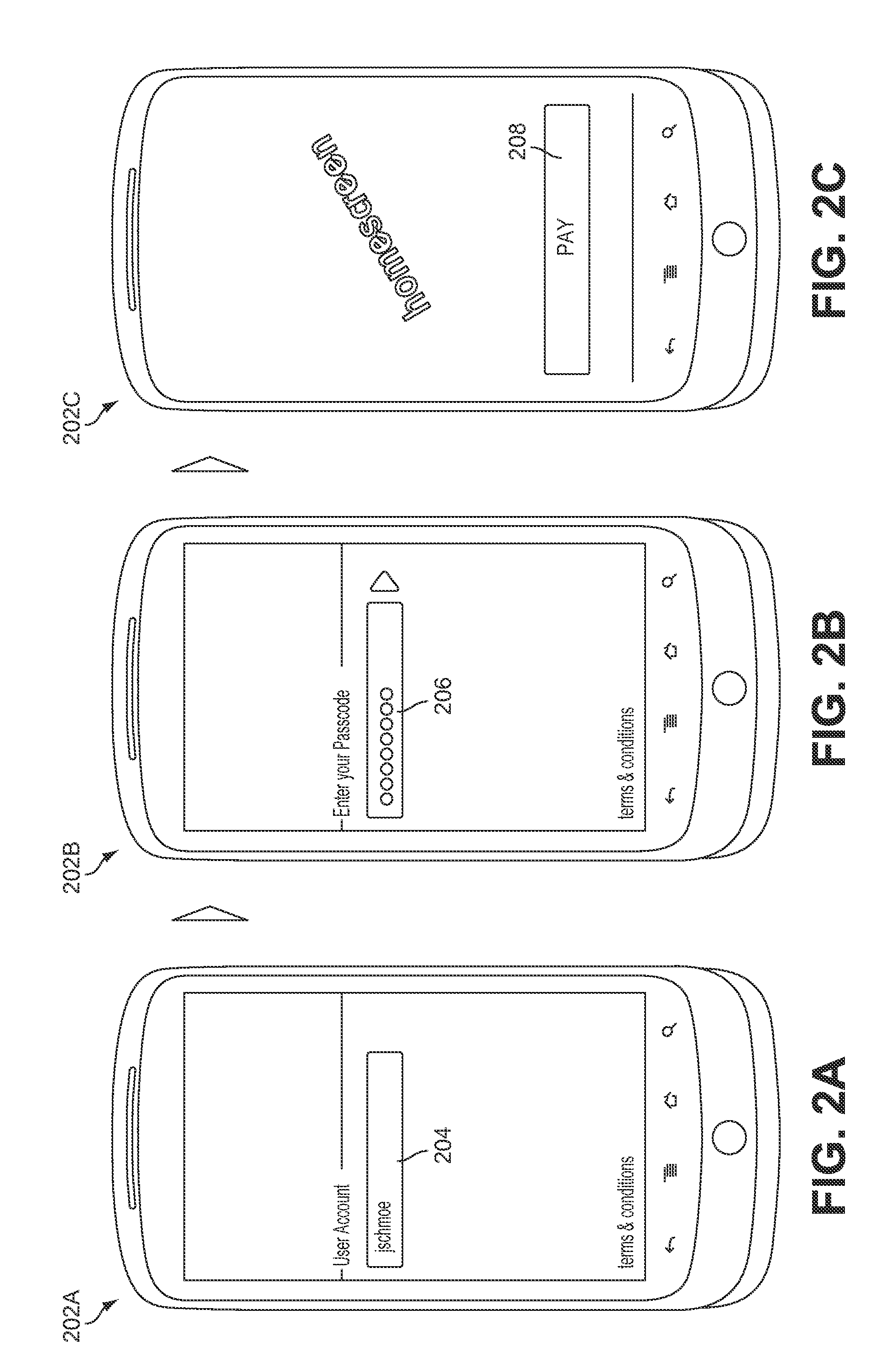

System and method for managing transactions with a portable computing device

A method and system include verifying credentials for gaining access to a central mobile payment controller using the portable computing device (“PCD”). The central mobile payment controller may receive a merchant identifier corresponding to a merchant and then it may compare the merchant identifier against loyalty account data stored in a database. The central controller may also receive product scan data and compare the product scan data against one of offer data and coupon data in a database. After these comparisons, any matches of product scan data to offer data or coupon data may be sent to the PCD and an electronic cash register (“ECR”). Similarly, any matches of the merchant identifier to loyalty account data may be transmitted to the PCD and ECR. During or after the purchase transaction, a message may be generated by the central mobile payment controller which lists one or more preferred payment options.

Owner:QUALCOMM INC

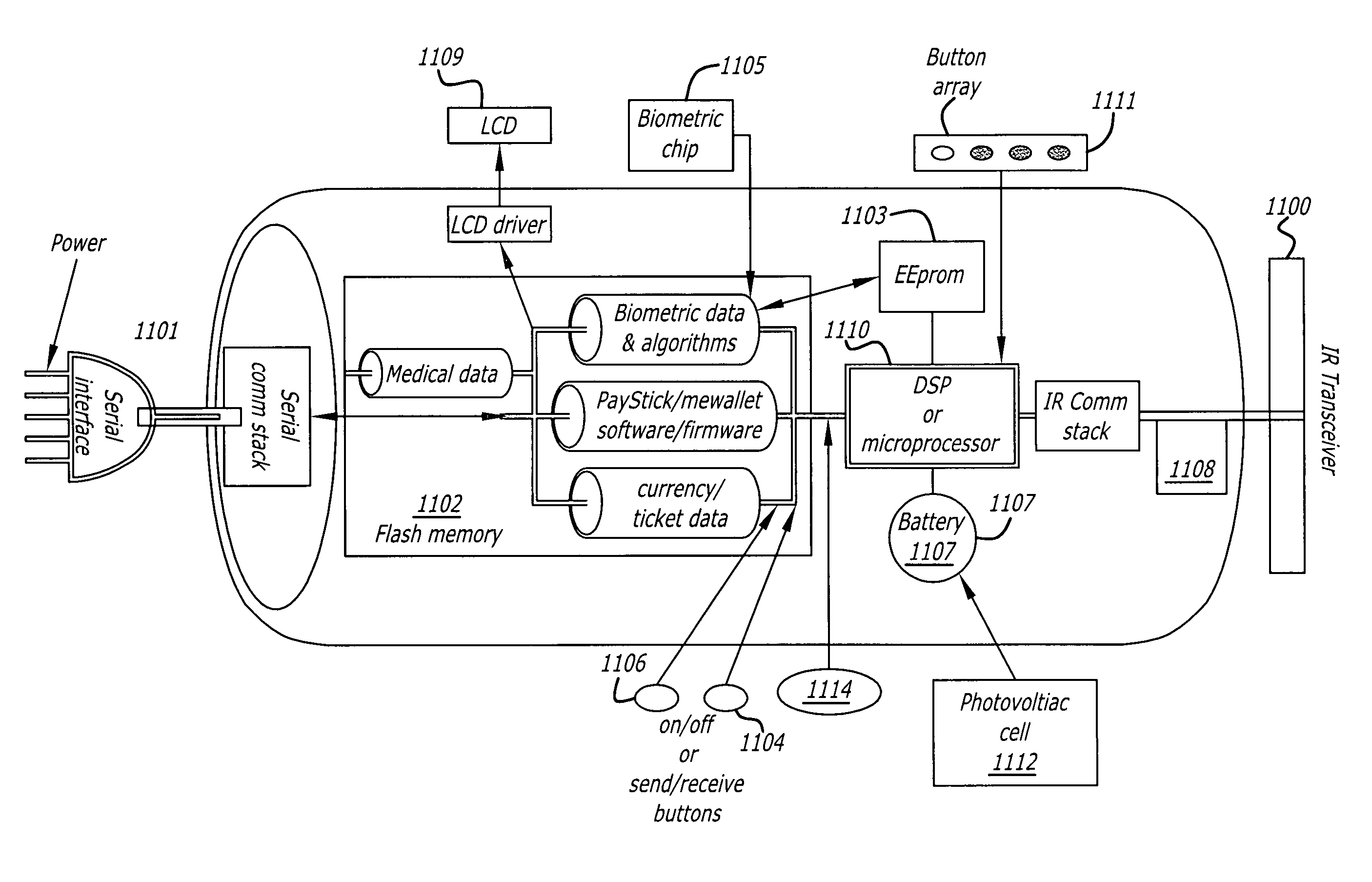

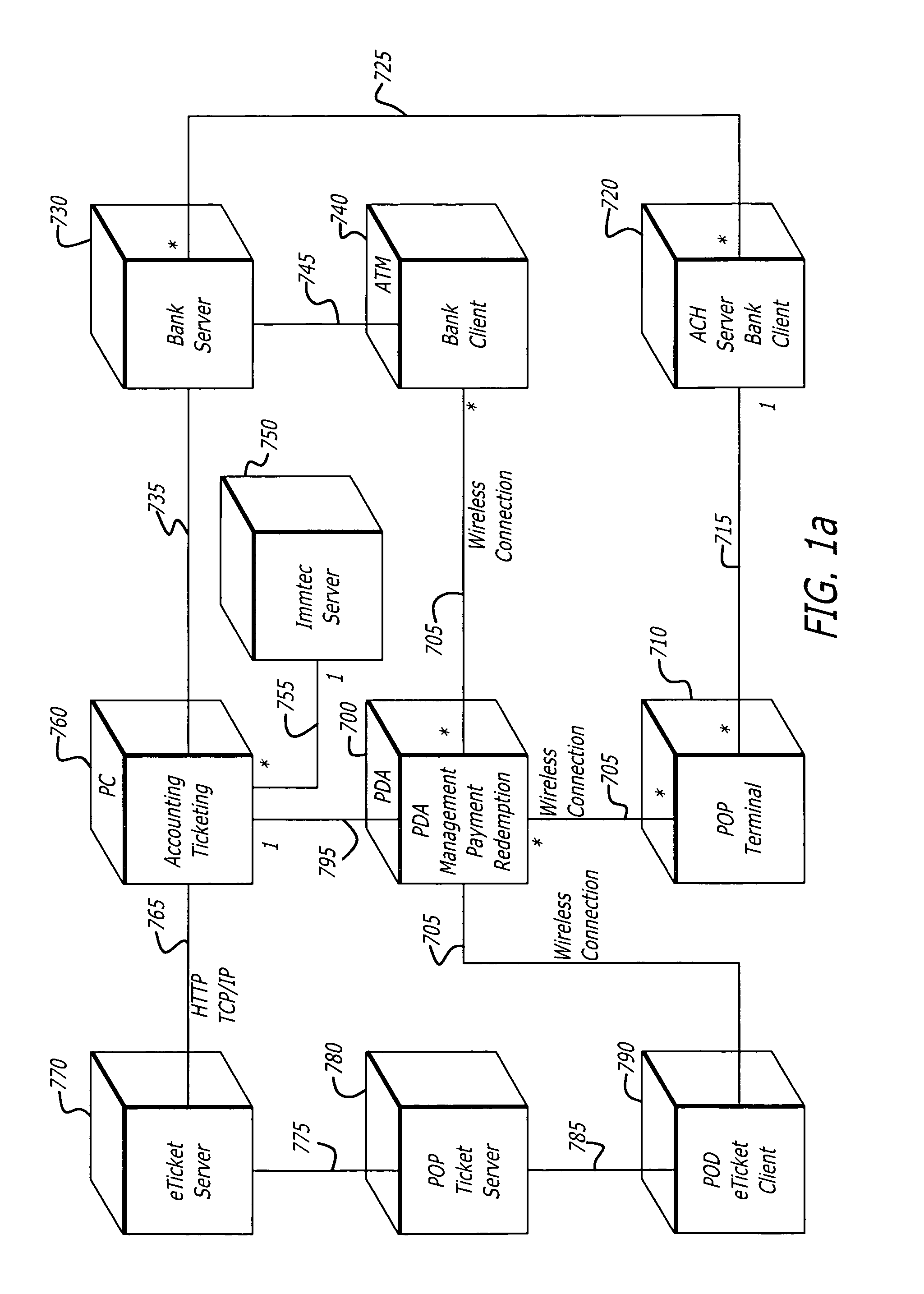

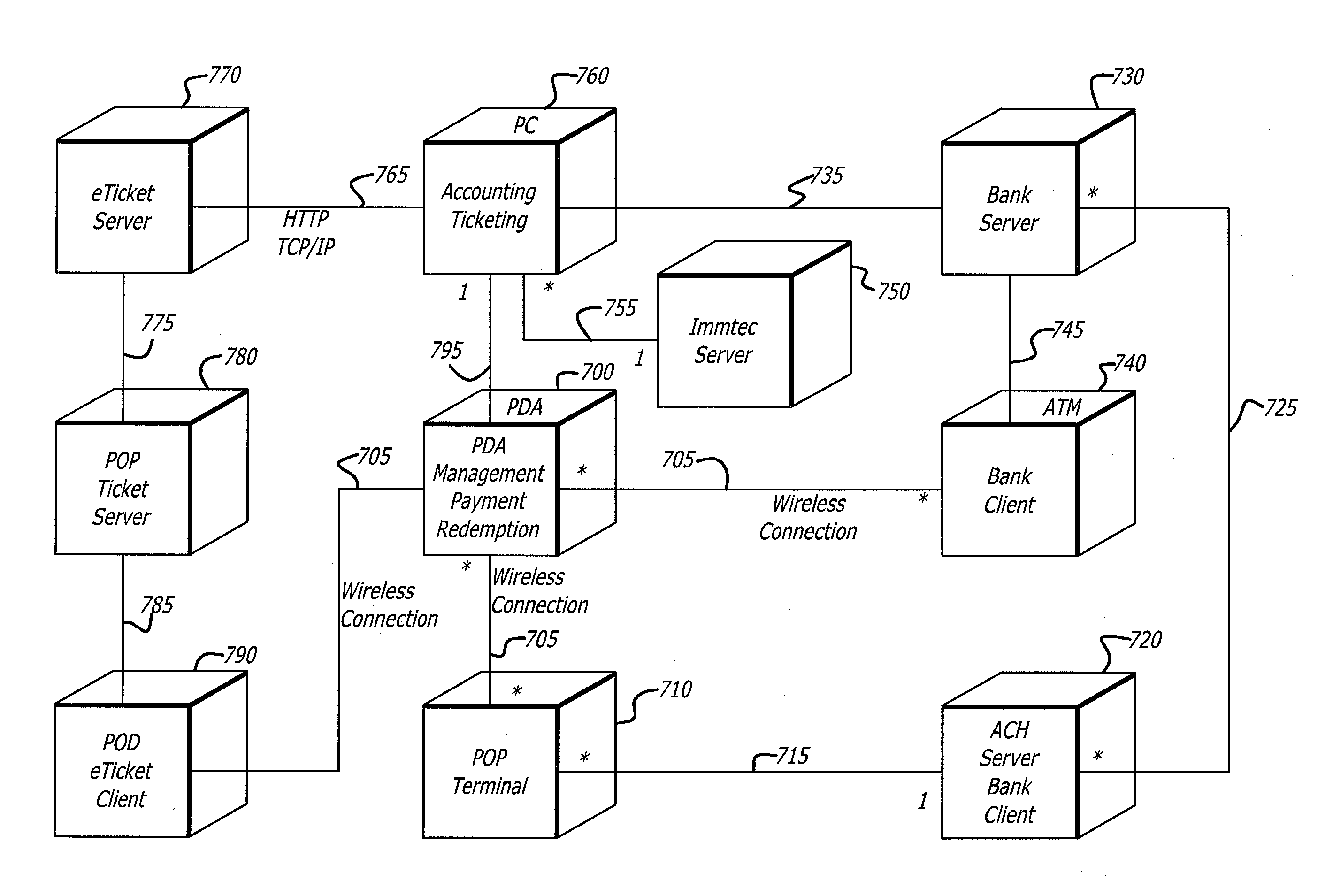

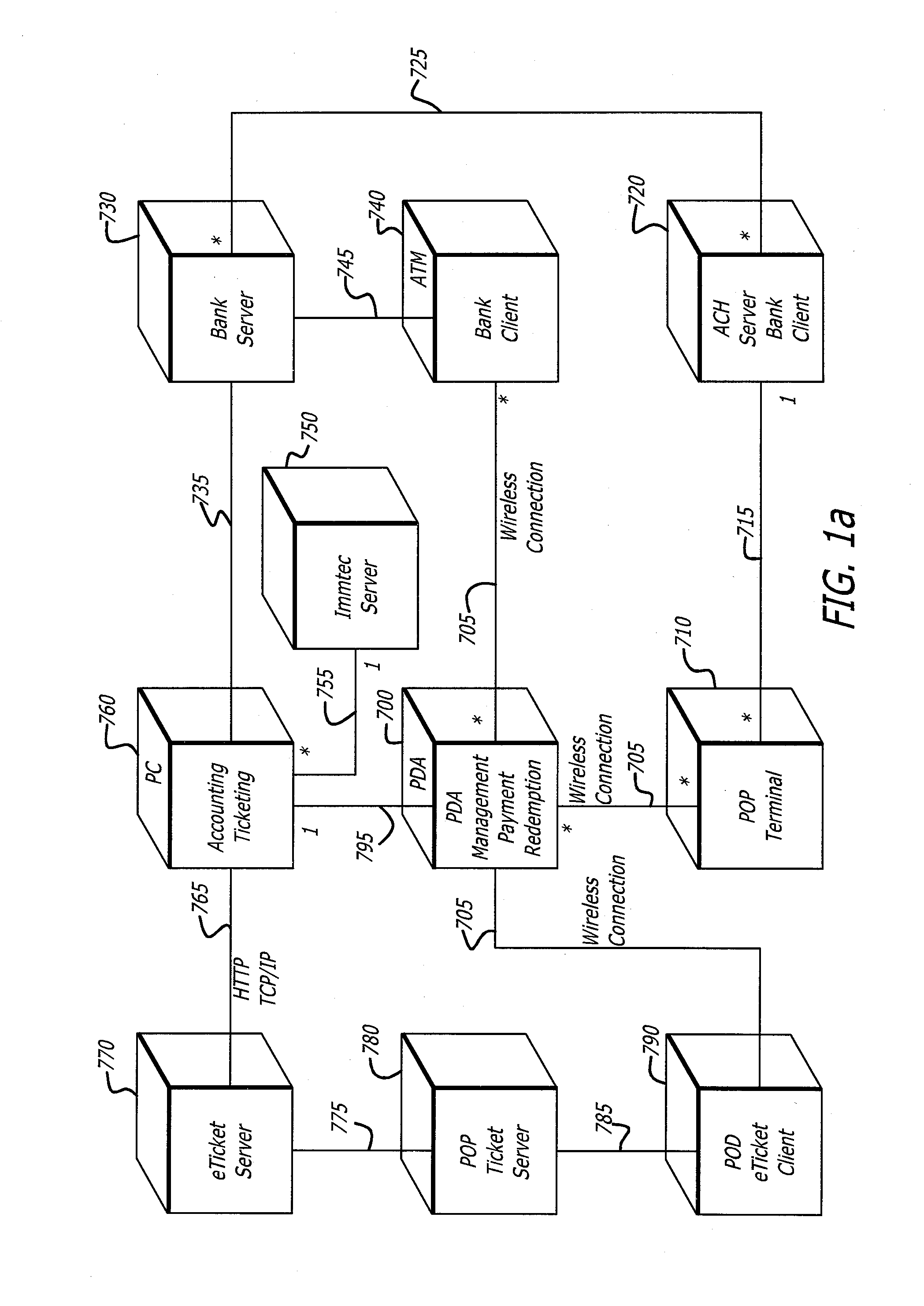

Apparatus, systems and methods for wirelessly transacting financial transfers , electronically recordable authorization transfers, and other information transfers

The present invention provides apparatus, systems and methods to wirelessly pay for purchases, electronically interface with financial accounting systems, and electronically record and wirelessly communicate authorization transactions using Personal Digital Assistant (“PDA”)(also referred to as Personal Intelligent Communicators (PICs), and Personal Communicators), palm computers, intelligent handheld cellular and other wireless telephones, and other personal handheld electronic devices configured with infrared or other short range data communications (for referential simplicity, such devices are referred to herein as “PDA's”). The present invention further provides apparatus, firmware, software programs and computer-implemented methods for making service and / or sale service charge payments for credit card charges, debit card charges, electronic cash transfers, ticket and other like financial transactions and for other types of transactions, such as for electronic coupons, where the amount of the transaction is for a small amount of money, such as, for example, less than $5.00.

Owner:SENTEGRA

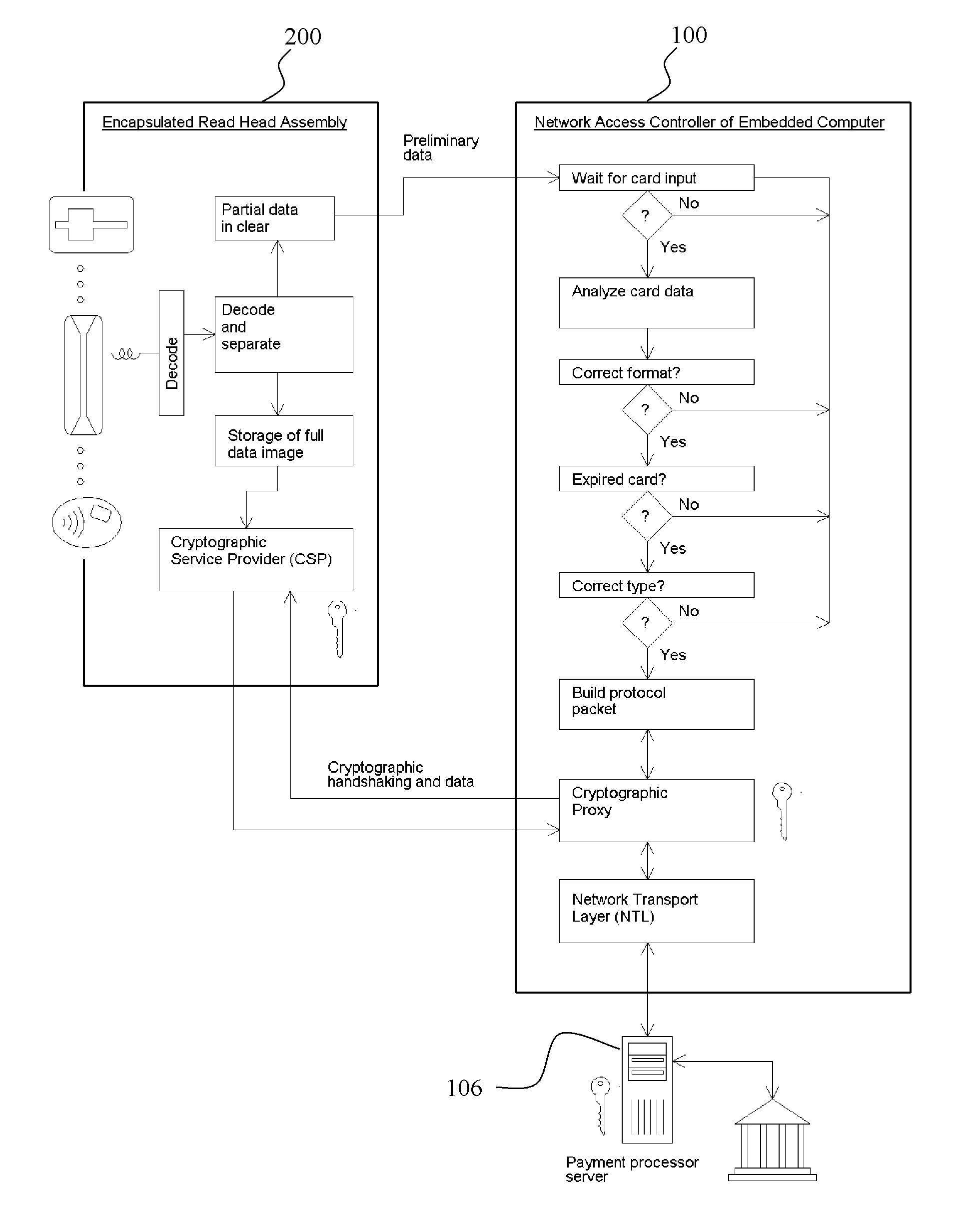

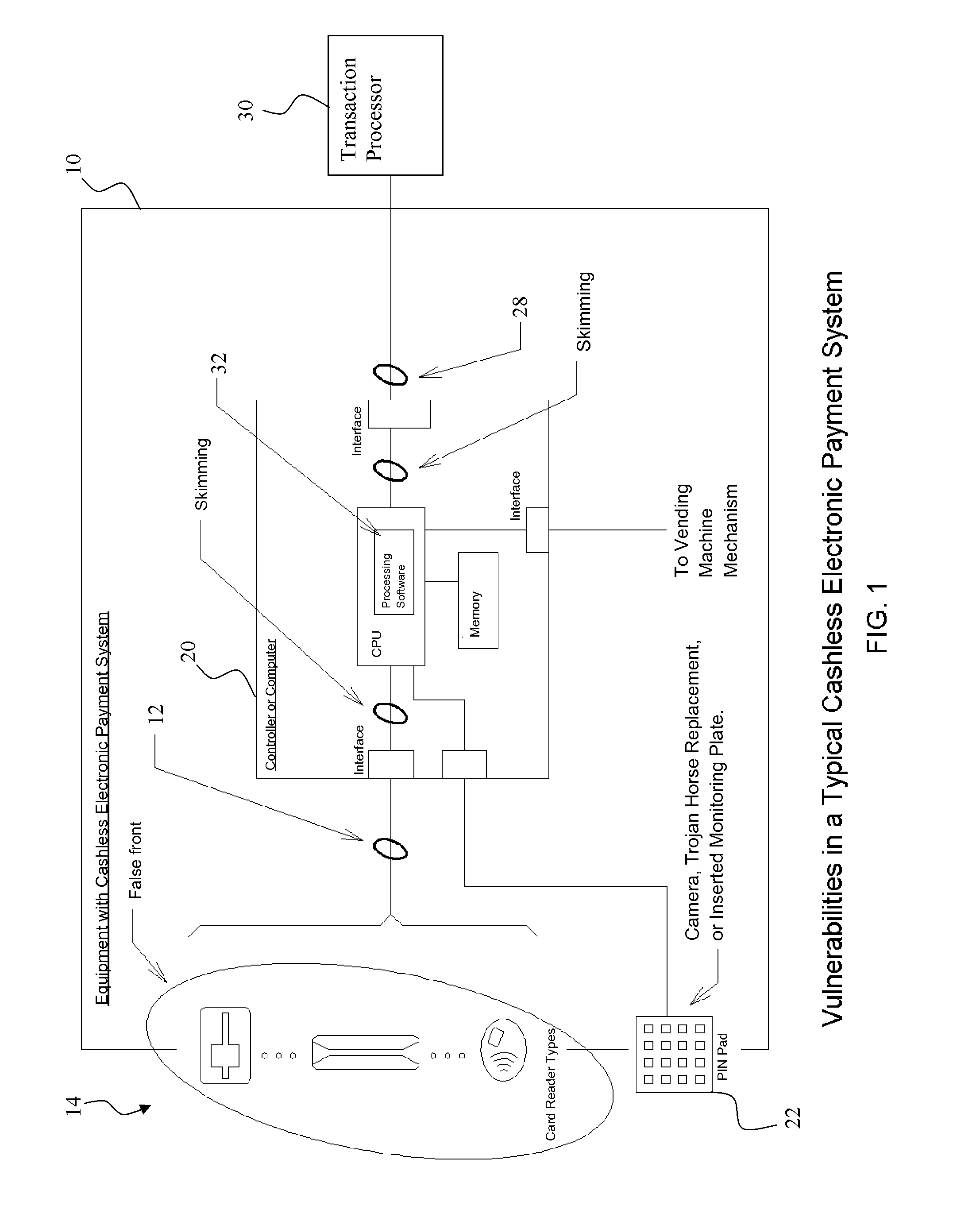

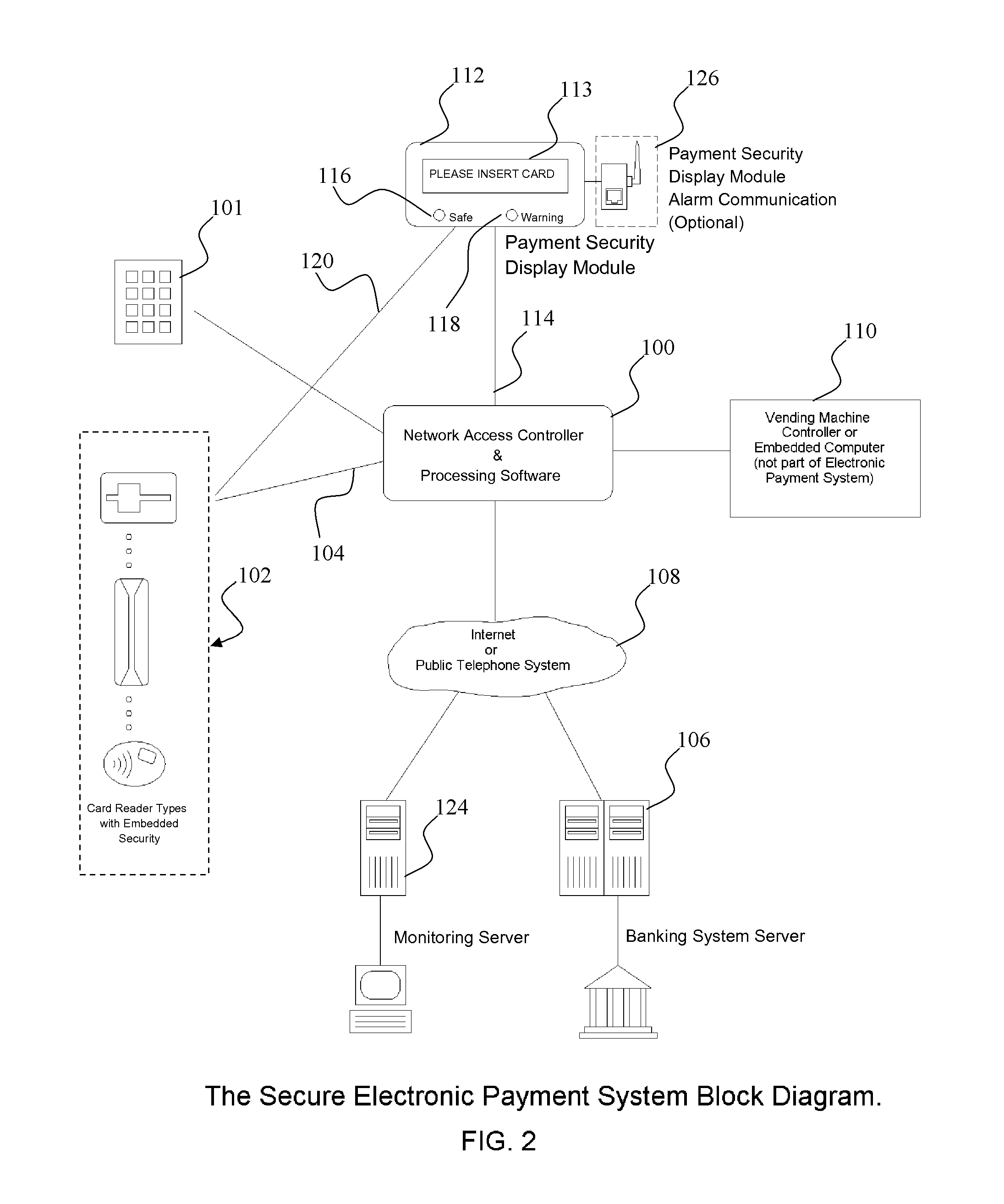

Secure electronic cash-less payment systems and methods

InactiveUS20110238581A1Improved fail-safe detectionImproved reporting mechanismAcutation objectsPayment circuitsEnd-to-end encryptionCredit card

Systems and methods to provide and maintain secure financial transaction conducted with a credit card or other cashless payment mechanism at a vending machine or other potentially unattended vending or point of sale device. Encapsulated card readers providing end-to-end encryption capabilities encrypt transaction data for secure transmission to a transaction host or server. Pre-authorization transaction data checking maintains account numbers in a secure encrypted format further enhancing security. Protection mechanisms that guard against, and provide warnings of equipment tampering, while also providing a visual indication to customers regarding the security of the system.

Owner:FORWARD PAY SYST

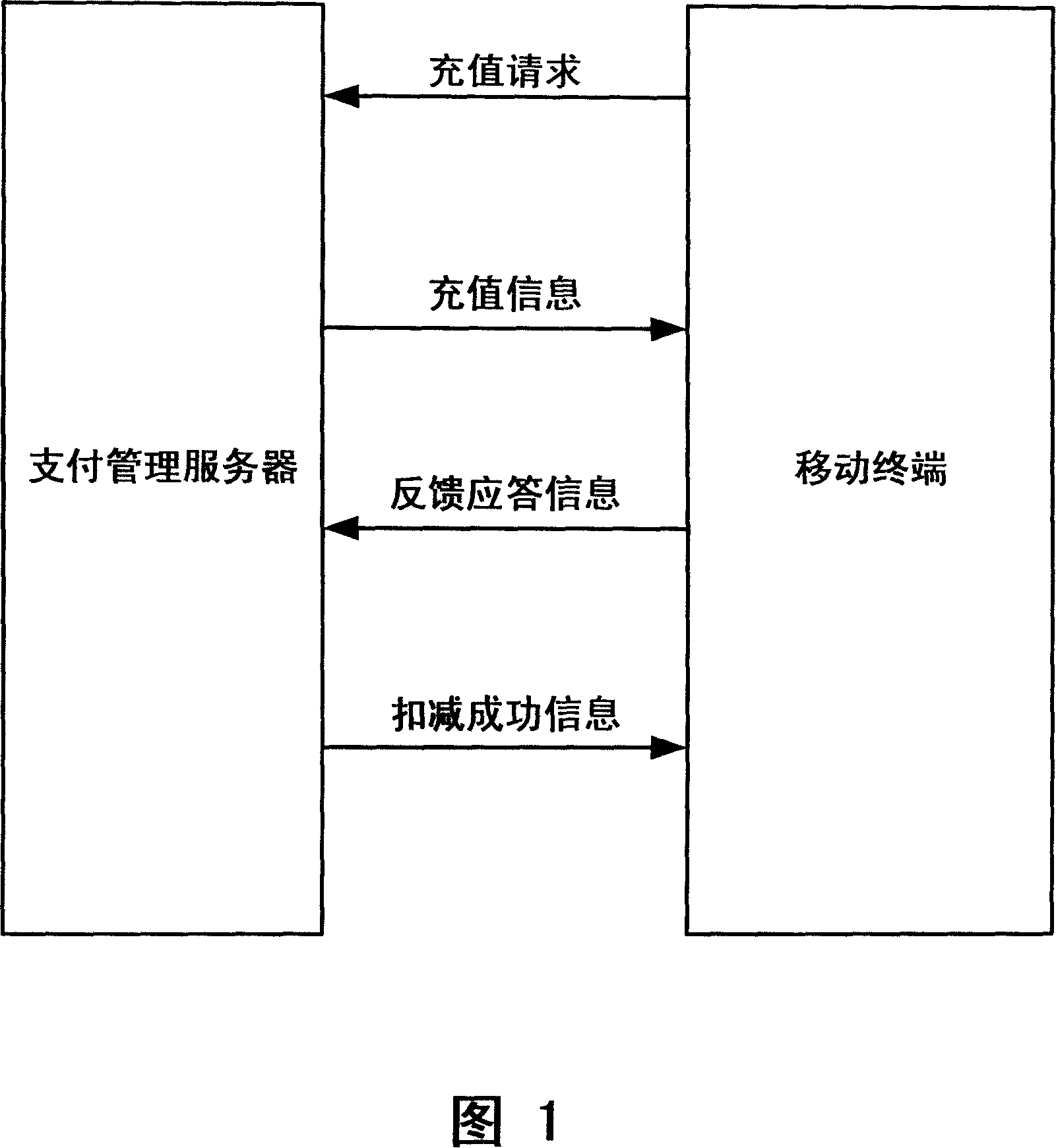

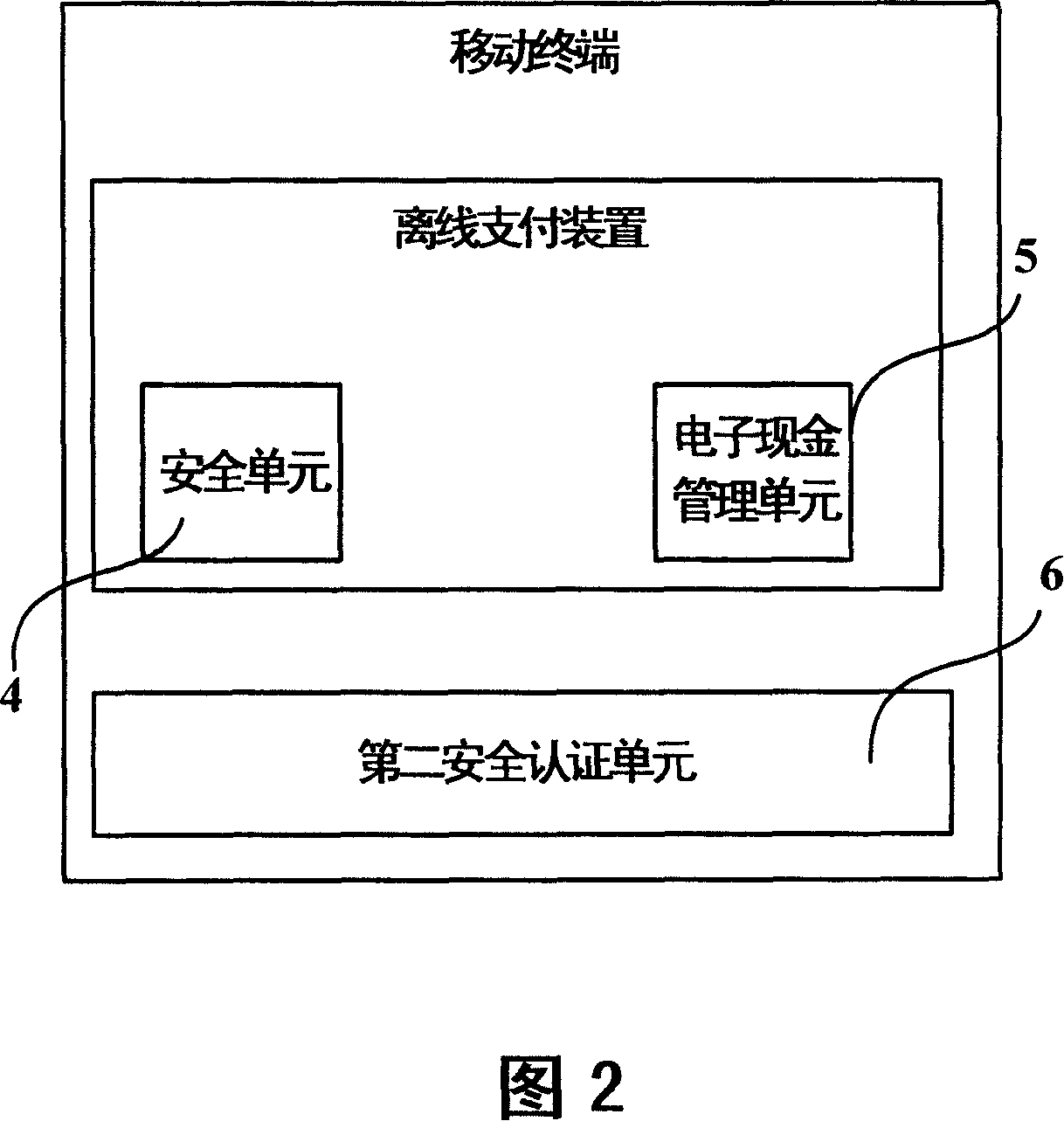

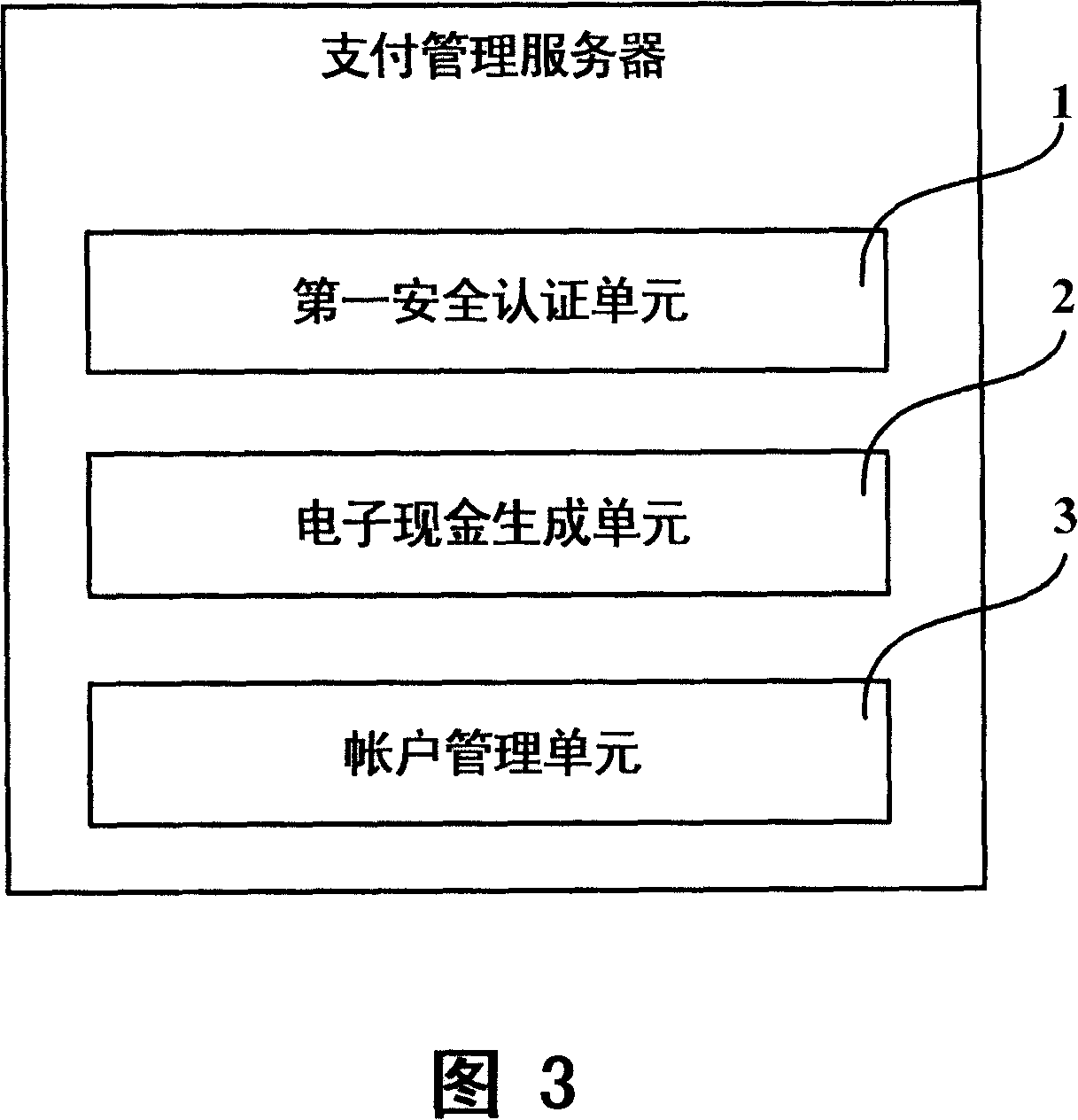

Security authentication system, device and method for electric cash charge of mobile paying device

ActiveCN101131756AEnsure safetyValid verification validityPre-payment schemesElectronic cashMobile end

This invention discloses the electron cash filling safety authentication system, device and method of the mobile payment device, the system includes the payment manager sever, the mobile end, and the off line payment device; the said payment manager sever includes the first safety authentication cell (1), encrypts and signs the filling information and the succeed account deduction information, and transfers them to the off line payment device by the encrypt transmission passage; validates the sign and deciphers the receipt feedback information at the same time; the said off line payment device includes the safety cell (4), which is used to validates the sign and deciphers the filling information and the succeed account deduction information; validates the sign and deciphers the feedback information according to the filling information at the same time, and transfers them to the off line payment device by the encrypt transmission passage. This invention also discloses a kind of electron cash filling safety authentication device and method of the mobile payment device. It can ensure the validity of the electron cash filling of the mobile payment device.

Owner:LENOVO (BEIJING) CO LTD

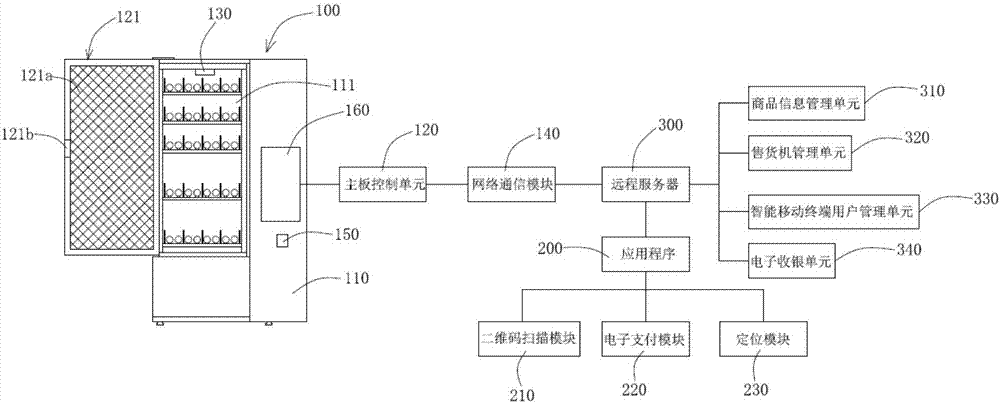

Self-service intelligent vending machine system

InactiveCN107134050AAvoid malfunctionLow mechanical failure rateCoin-freed apparatus detailsCo-operative working arrangementsElectronic cashNetwork communication

The invention discloses a self-service intelligent vending machine system. The system comprises vending machine, wherein the vending machine comprises a goods container, a mainboard control unit, a RFID reader, a network communications module and a two-dimensional bar code; an application program implantable in an intelligent mobile terminal, wherein the application program comprises a two-dimensional bar code scanning module and an electronic payment module; a remote server, wherein communications and interactions are conducted by the remote server through the network communications module with the mainboard control unit of the vending machine, the remote server comprises a goods information management unit, a management unit of the vending machine, a user management unit of the intelligent mobile terminal, and an electronic cash register unit. The self-service intelligent vending machine system has the profitable effects that more stable running of the vending machine is guaranteed, and buying experiences of the customers' are improved.

Owner:SHANGHAI YUKE SMART TECH

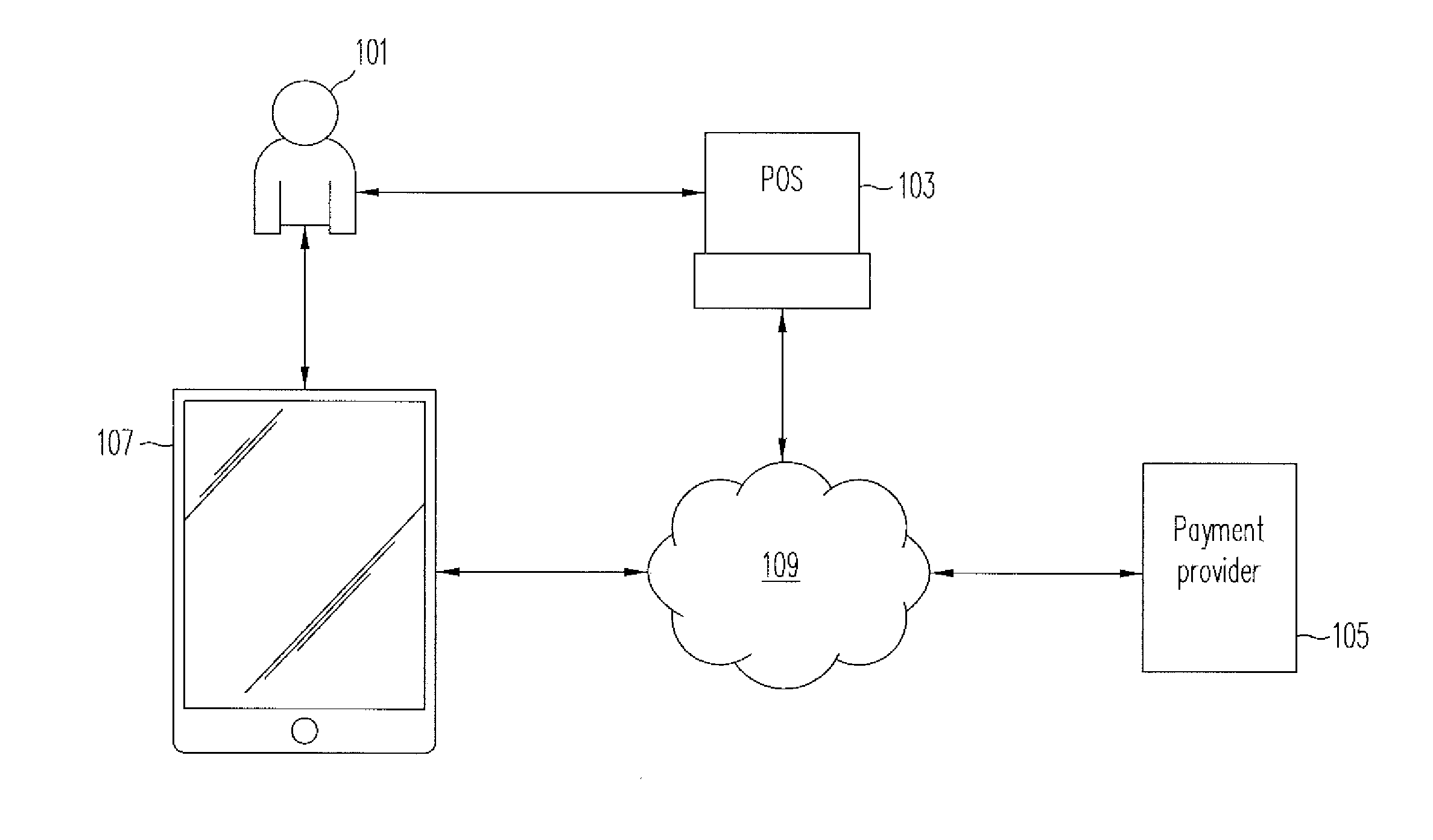

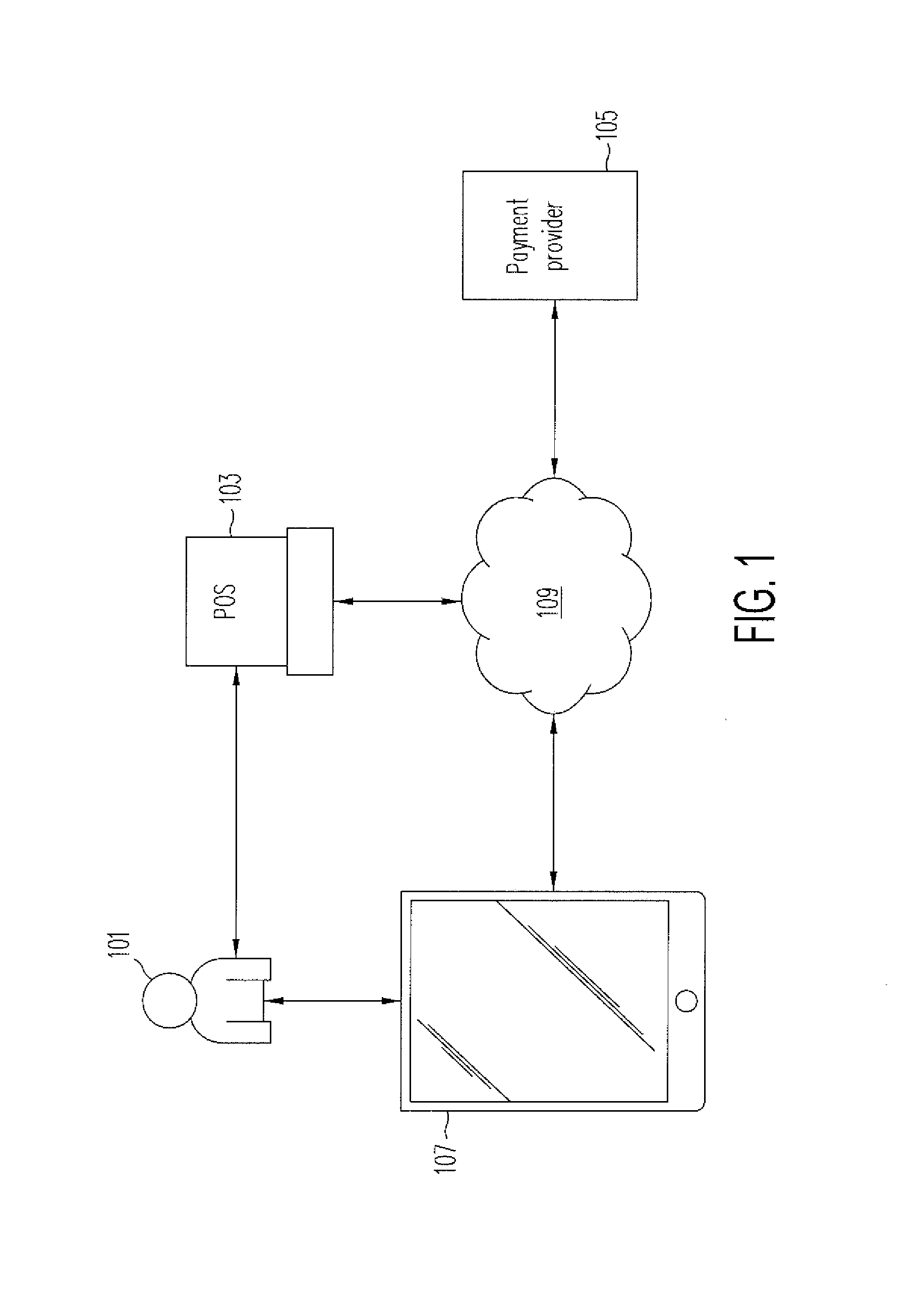

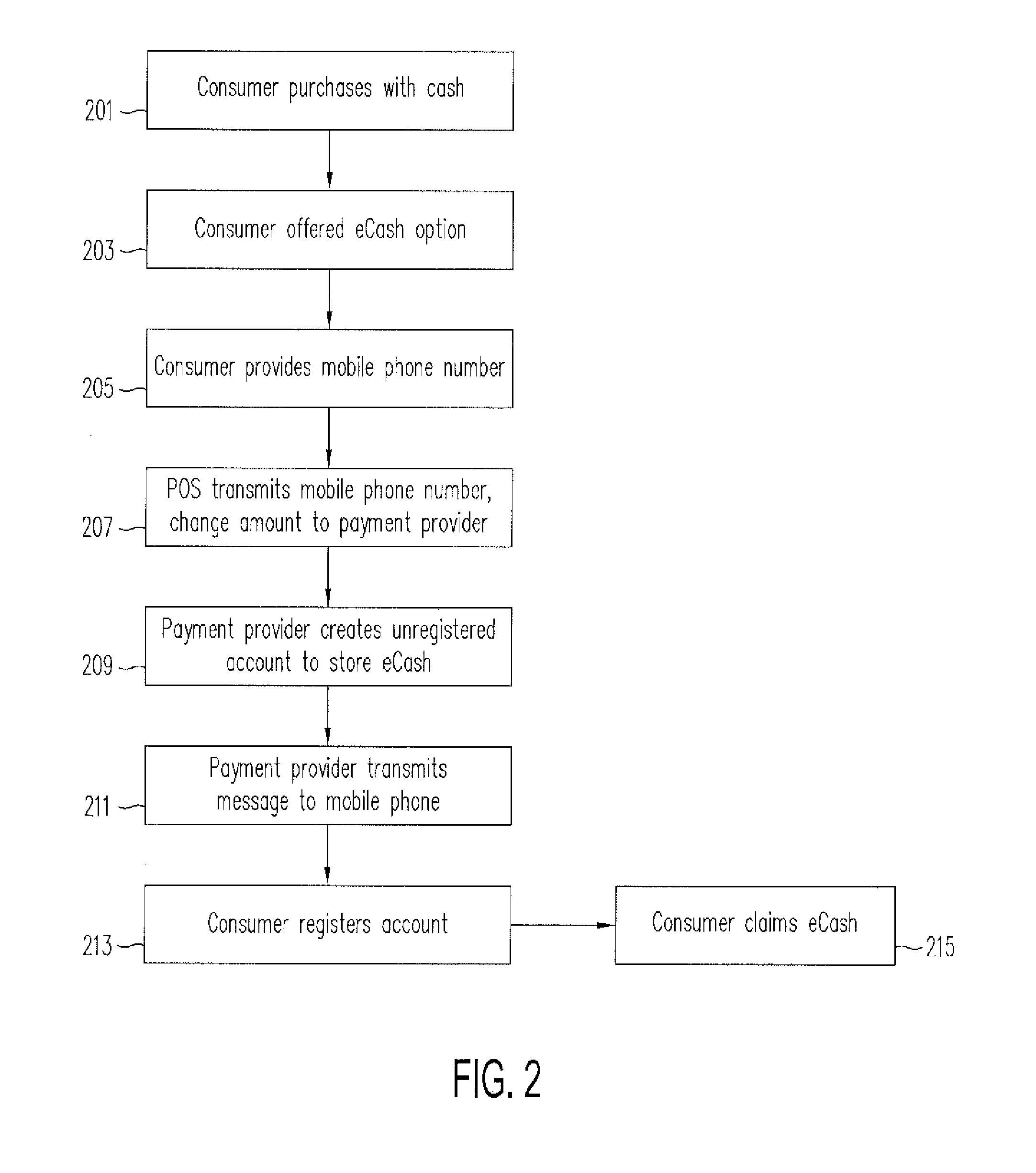

Driving New User Acquisition from Payment Transactions

Systems and methods are disclosed for a payment service provider to provide benefits through provisional accounts established at in-store checkout to consumers who do not have accounts with the payment service provider to drive use sign-up. The payment service provider may offer cash paying consumers electronic cash stored in provisional accounts instead of any change at a point-of-sale, or offer credit card paying consumers a guest checkout experience to receive discounts, incentives, or rewards. The consumers are asked to provide identifying information such as a phone number of their mobile devices. A provisional account is established and linked it to the identification information if the provisional account does not already exist. Otherwise, the payment service provider may verify that the provisional account has not expired. The payment service provider may send reminders to the mobile devices to encourage the consumers to register an account before the provisional account expires.

Owner:PAYPAL INC

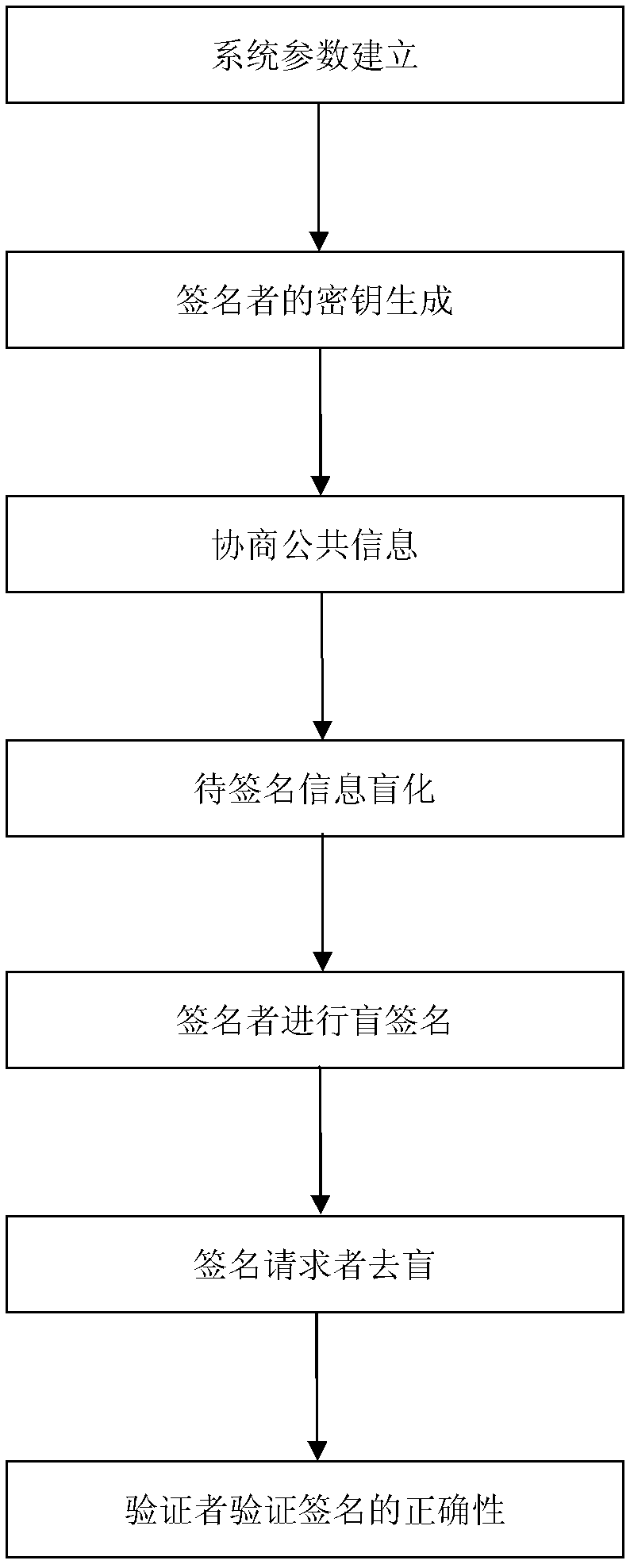

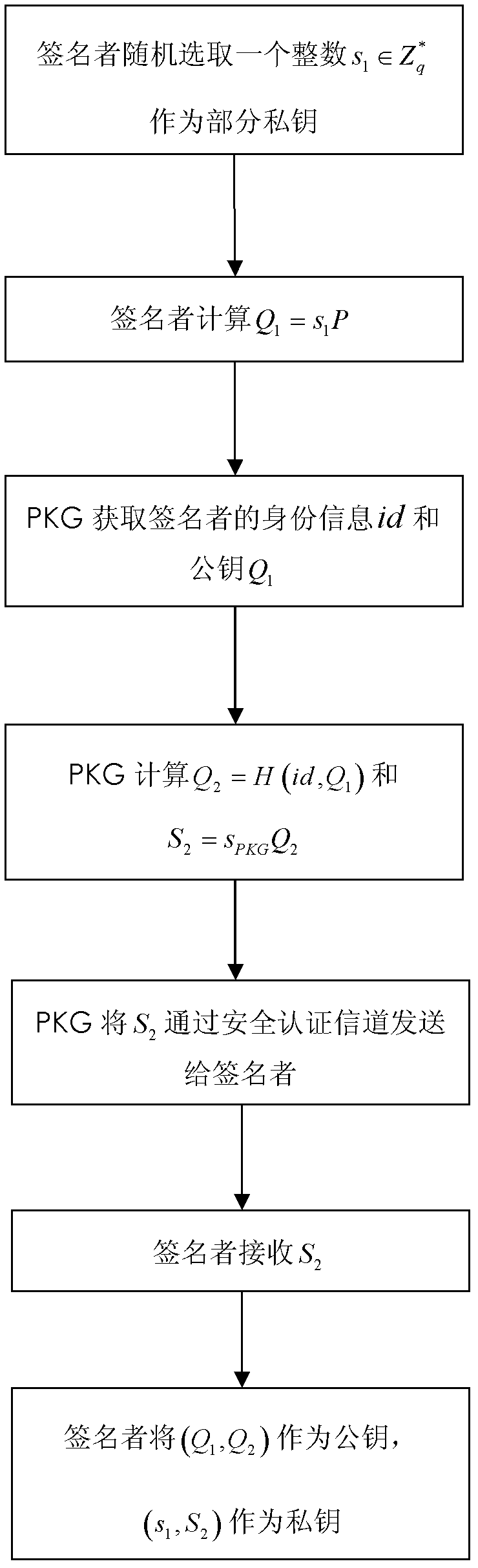

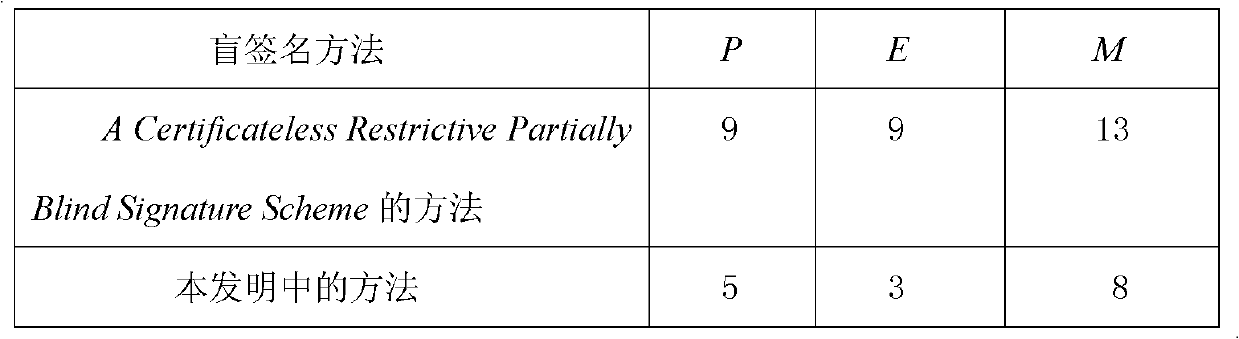

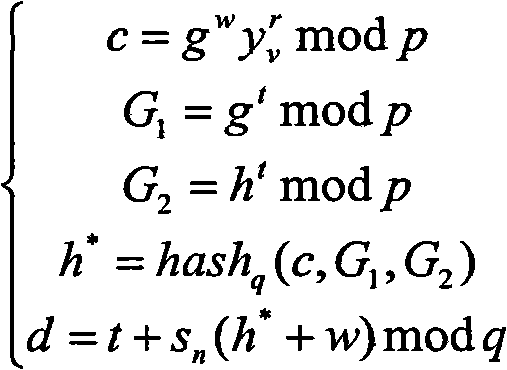

Certificateless partially blind signature method

InactiveCN102387019AEliminate demandTroubleshoot hosting issuesPublic key for secure communicationUser identity/authority verificationElectronic cashKey escrow

The invention relates to a certificateless partially blind signature method. In the prior art, practicality of the partially blind signature method is low. The method of the invention is mainly used to solve the above problem. The method comprises the following steps that: 1) a secret key generation center randomly selects an integer sPKG as a private key in an integer multiplication group of mod q and stores secretly, and discloses a system parameter: (G1, q, 1, P, G2, e, H, h, QPKG); 2) a signer generates the partial private key s1 and a partial public key Q1, the secret key generation center generates the other partial private key S2 and the public key Q2 and sends to the signer through a safe authentication channel, and the signer acquires a private key pair (s1, S2) and a public key pair (Q1, Q2); 3) the signer carries out signature; 4) an authenticator verifies validity of the signature by using the public key pair (Q1, Q2) of the signer. By using the method of the invention, a demand to a certificate can be eliminated. There is no disadvantage of secret key escrow. A partial blind characteristic is possessed. Simultaneously, the method is simple and high efficient and possesses good practicality and security. The method can be used in an electronic cash transaction and electronic voting.

Owner:XIDIAN UNIV

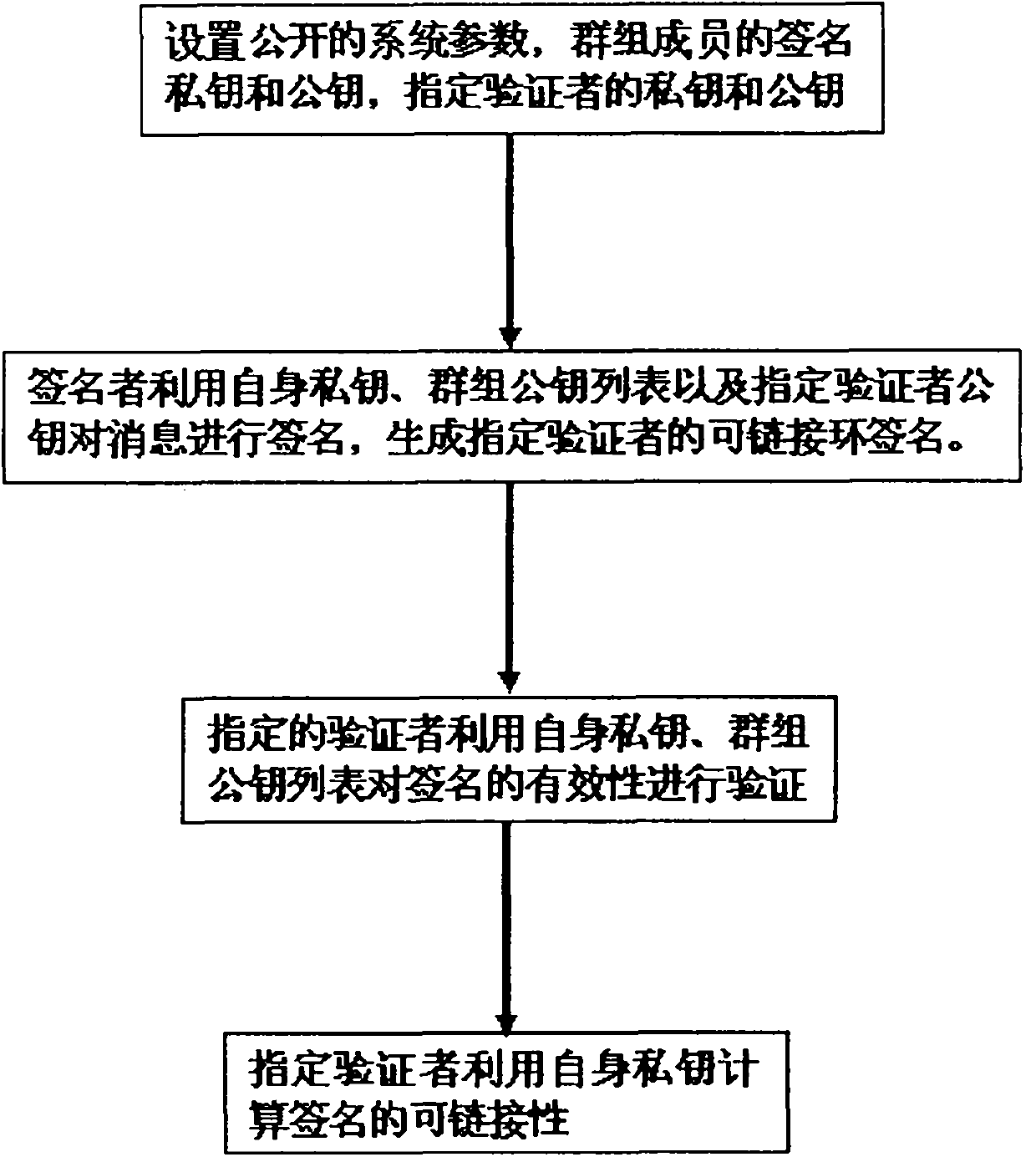

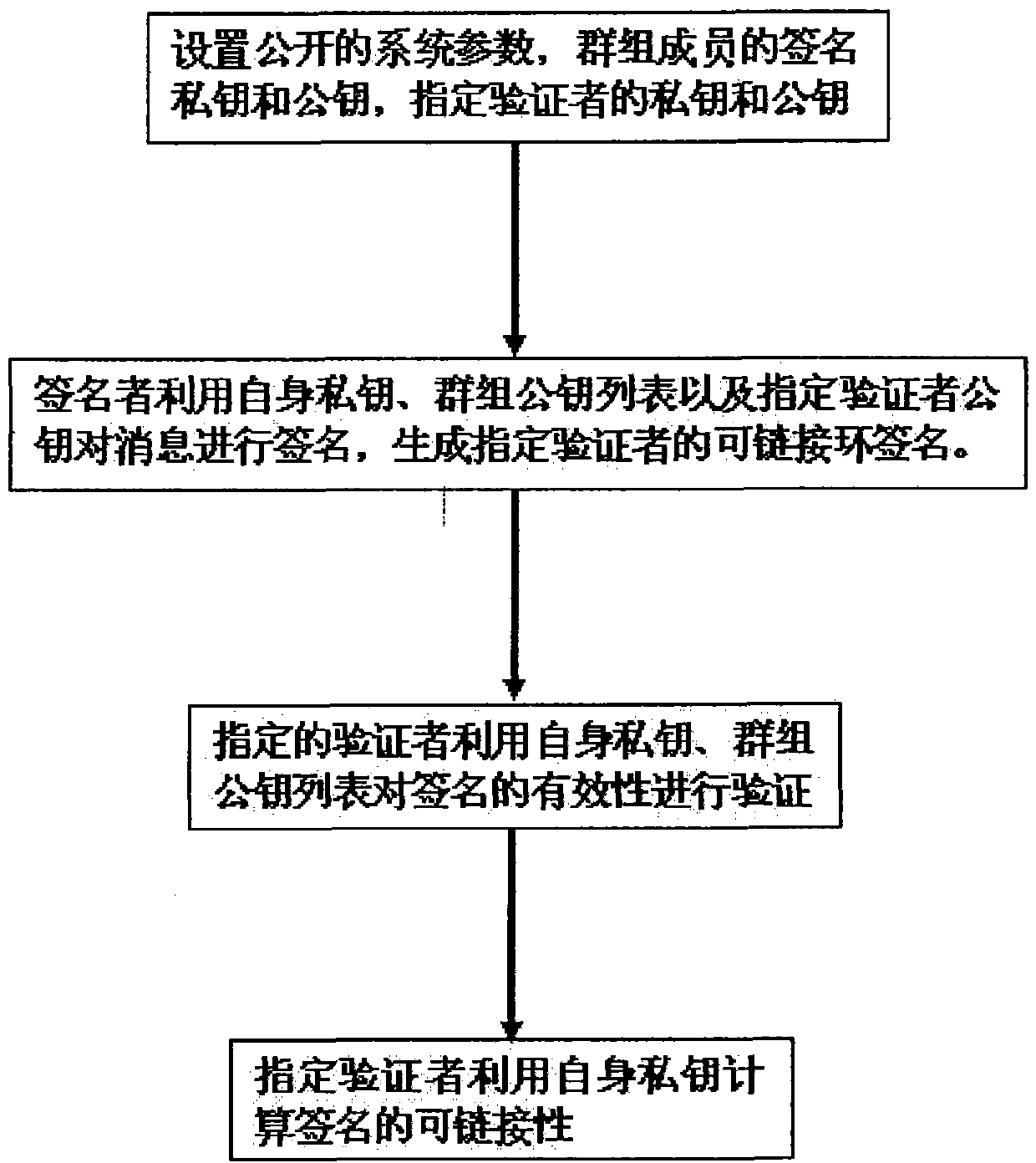

Linkable ring signature method based on appointed verifier

InactiveCN102377565AImprove efficiencyKey distribution for secure communicationPublic key for secure communicationRing signatureElectronic cash

The invention relates to a linkable ring signature method based on an appointed verifier. In the method, a non-interactive zero-knowledge proof technology is adopted, and a linkable ring signature based on the appointed verifier is realized under the hypothesis of the difficulty in a bilinear Diffie-Hellamn problem. According to the invention, the problems that no linkable ring signature method based on the appointed verifier is available in the prior art and the linkable ring signature cannot be used to solve the problem of receipt-freeness in electronic-cash and electronic voting are solved.

Owner:陈国敏 +1

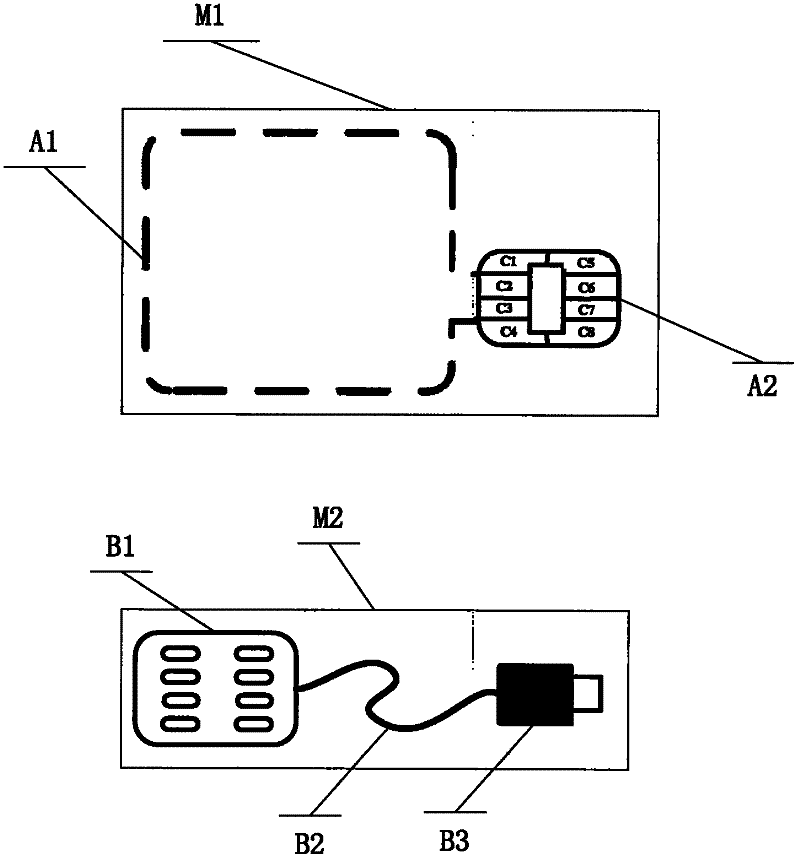

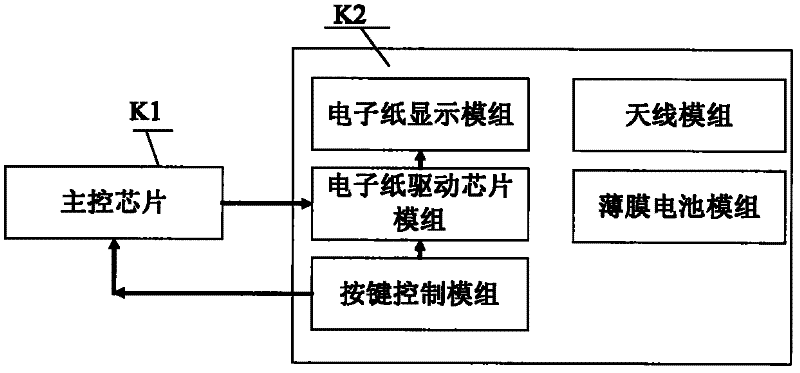

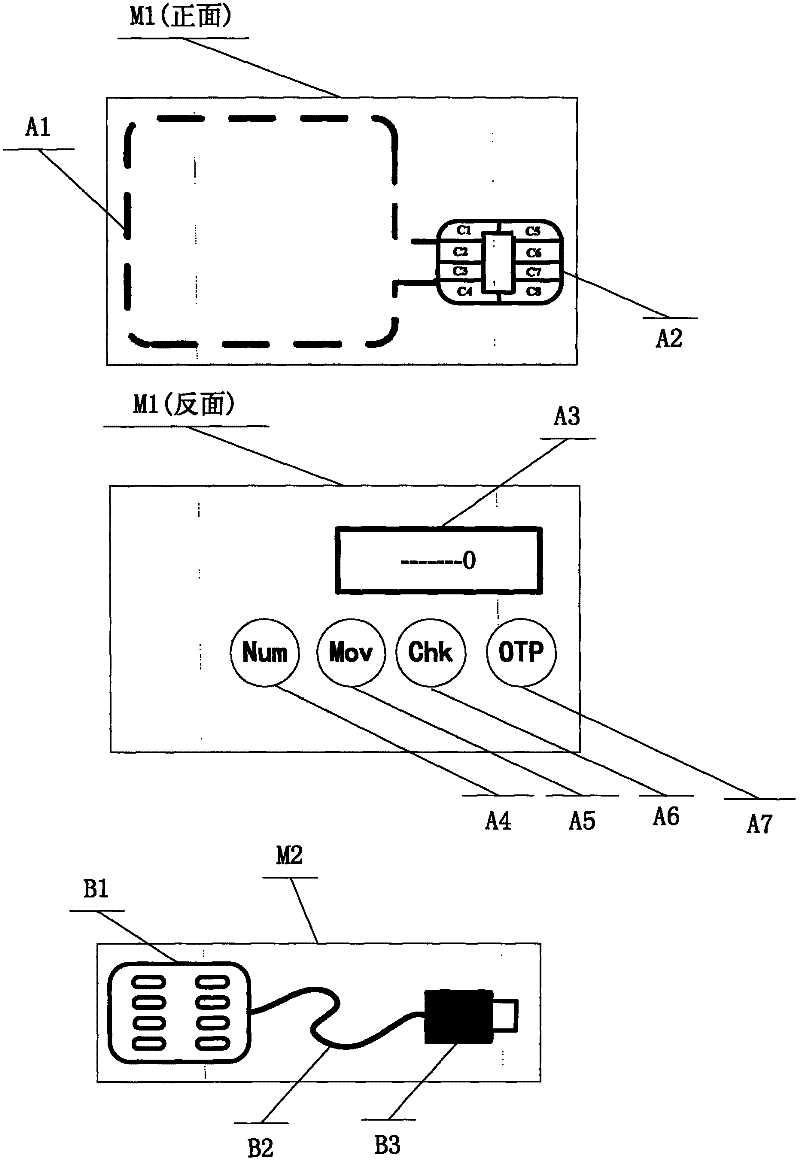

Multifunctional visual intelligent card

InactiveCN102542323ADigital data authenticationRecord carriers used with machinesKey pressingElectronic cash

The invention provides a multifunctional visual intelligent card and relates to the field of application of a USBKEY (Universal Serial Bus Key), an OTP (One Time Password) dynamic password and a financial IC (Integrated Circuit) card. The invention provides the visual intelligent card which is integrated with functions of the USBKEY, an OTP and the financial IC card. Three carriers can be combined, the functions of an OTP dynamic password card, the financial IC card and the USBKEY are implemented by one carrier, and a user conveniently selects to use the functions. According to the invention, by a battery, keys and visual electronic paper which are embedded in the intelligent card, the functions of the generation and display of the OTP dynamic password, the information input and authentication of the USBKEY in the authentication process and the display and query of electronic cash balance of the financial IC card are implemented.

Owner:BEIJING CEC HUADA ELECTRONIC DESIGN CO LTD

Electronic cash eliminating payment risk

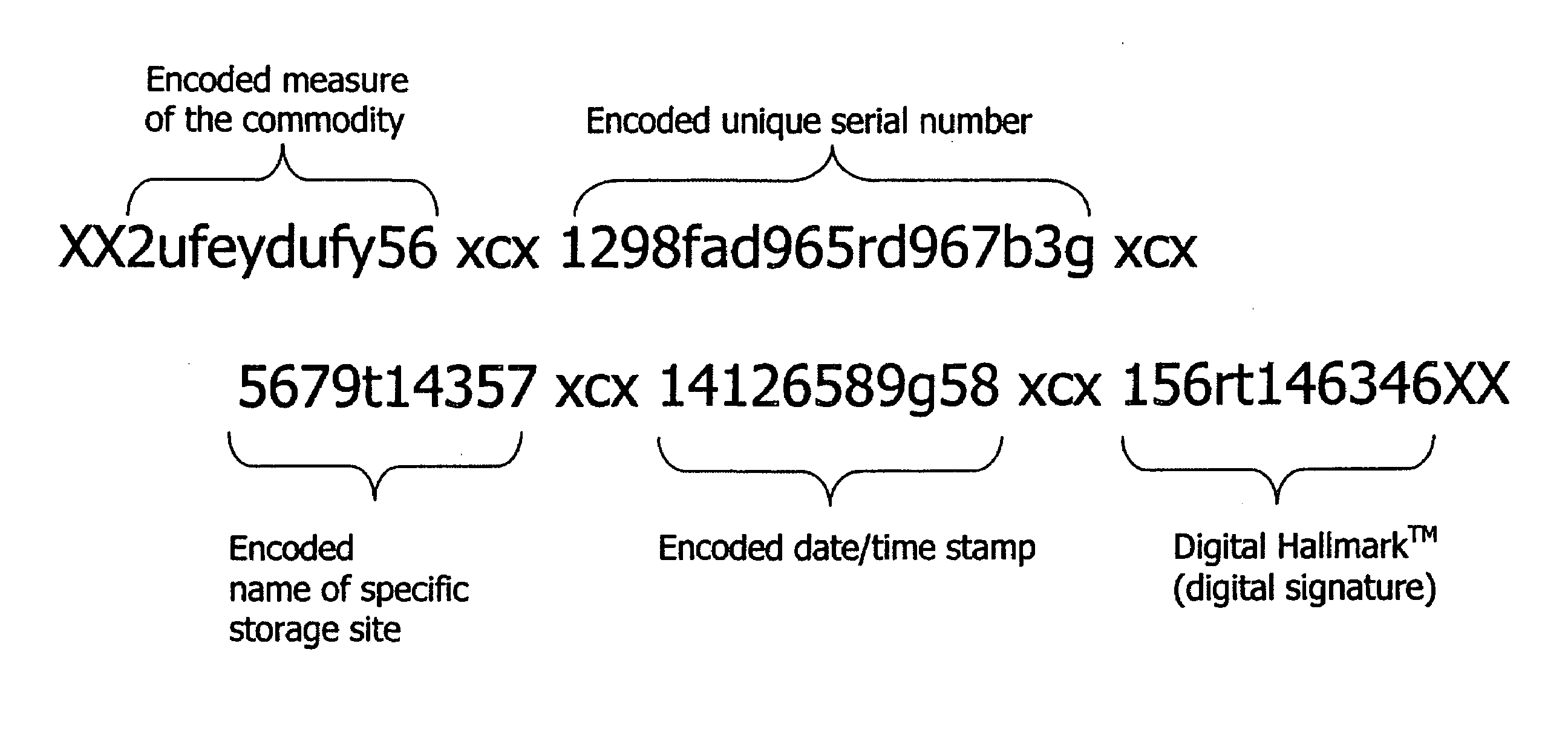

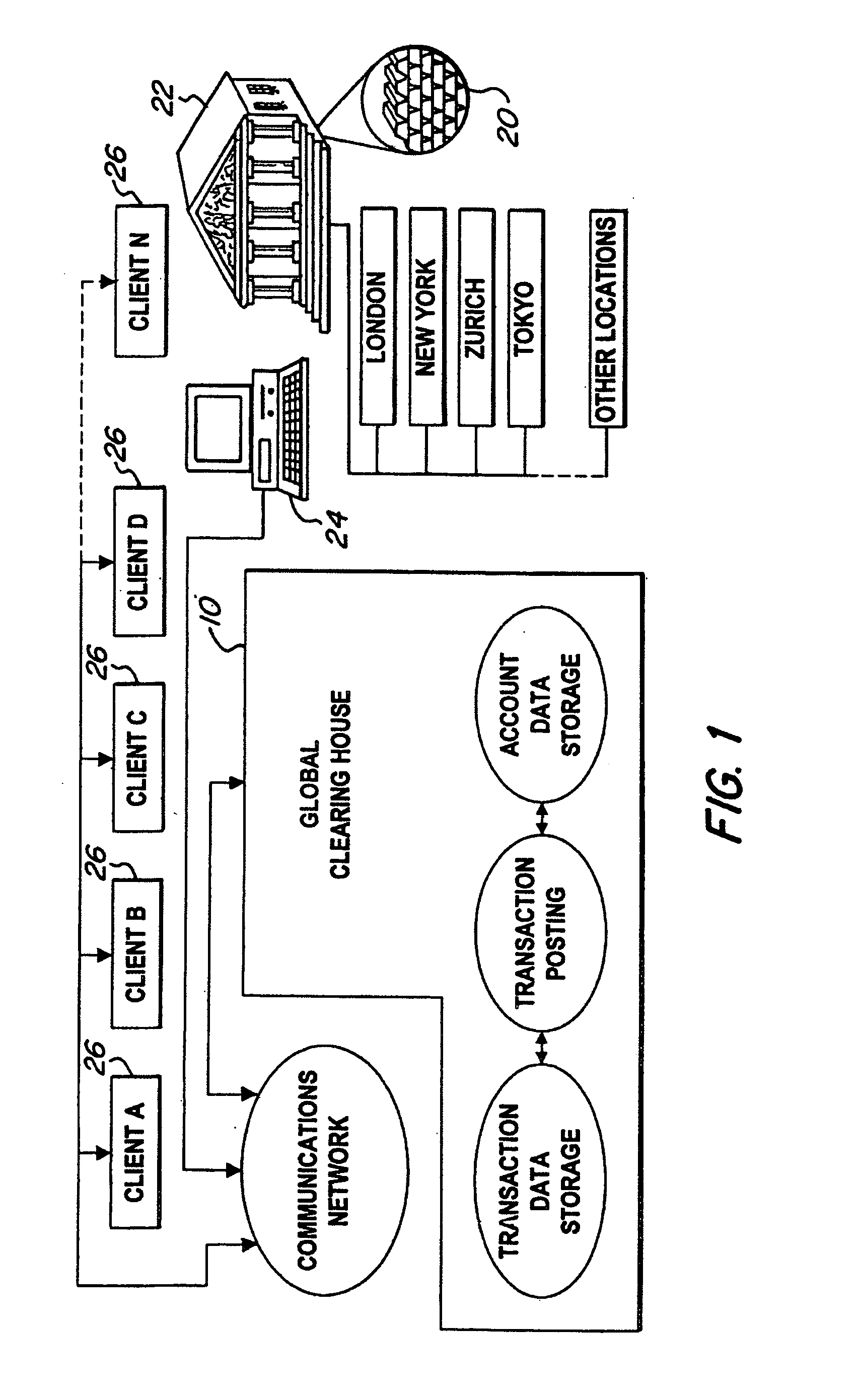

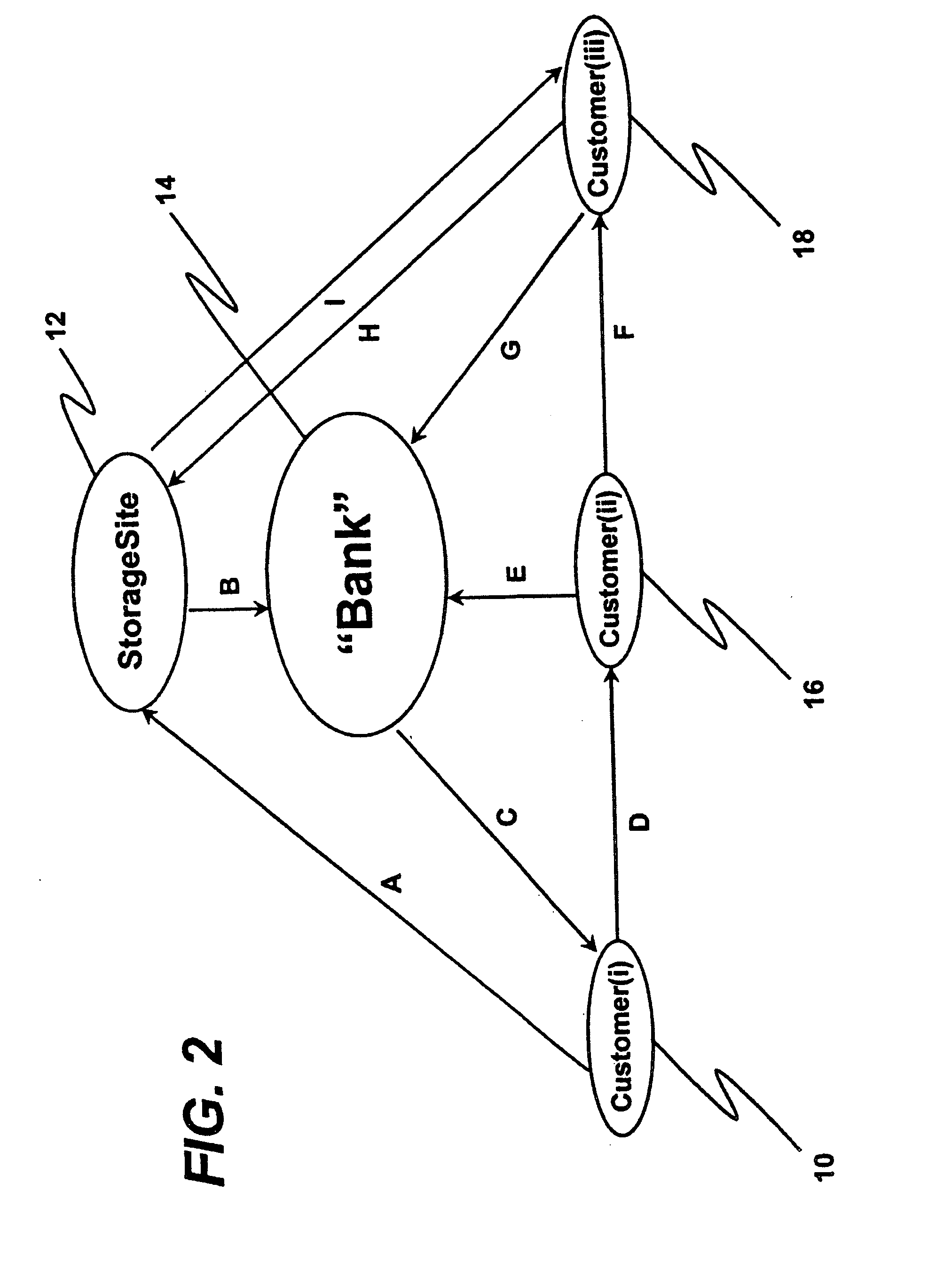

InactiveUS7143062B2Avoid problemsIncrease efficiency and suretyFinancePre-payment schemesPrivate communicationGram

A system and method for permitting gold or other commodities to circulate as currency requires a network of system users that participate in financial transactions where payment is made in units of gold. The gold is kept in secure storage at a deposit site for the benefit of the users. The payments in gold are effected through a computer system having data storage and transaction processing programs that credit or debit the units of account of gold for the account of each system user. The system and method allows gold to circulate as an electronic payment through the global computer network (Internet) and / or private communication networks. The sum total of all circulating electronic gold (denominated in physical measures such as weights such as grams and / or ounces and fractions thereof) will equal the weight of all the gold held for safekeeping at the storage site(s) for the users of the system.

Owner:BITGOLD BVI INC

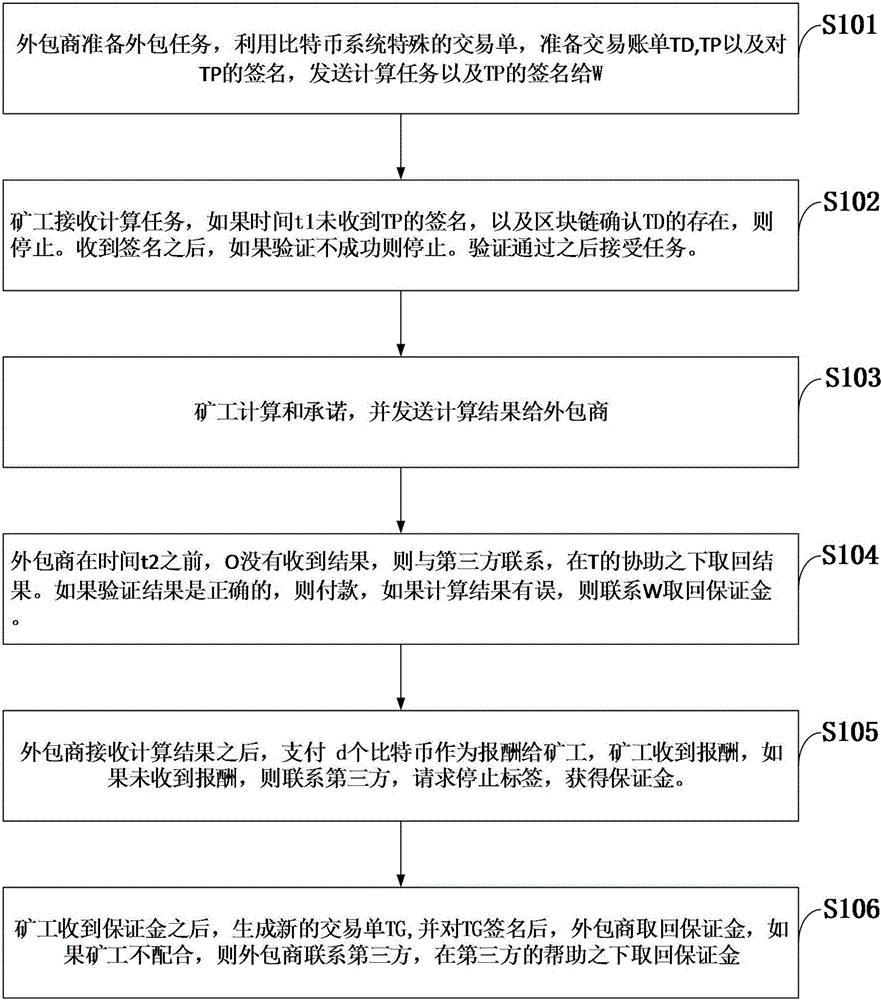

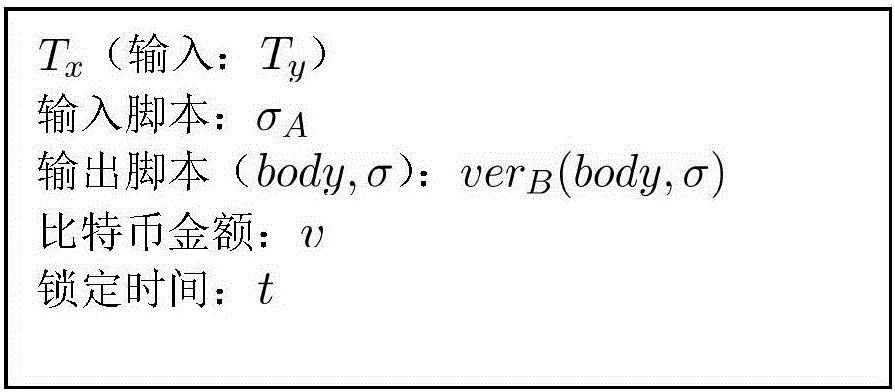

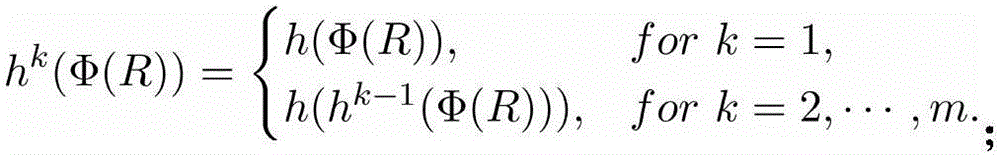

Bitcoin-based outsourcing calculating fair payment method

The invention discloses a bitcoin-based outsourcing calculating fair payment method. According to the Bitcoin-based outsourcing calculating fair payment method, an outsourcer O and a miner W are defined; O and W first reach an agreement; O pays a deposit, wherein the deposit can be adopted as a compensation for W who honestly completes a task while does not get a remuneration; and after the agreement is completed, O will pay the remuneration within a time limit, otherwise, O will lose the deposit. The method of the present invention differs from traditional electronic cash in that the bitcoin is a point-to-point distributed electronic cash system in which users can directly carry out transaction without the assistance of banks. The method of the present invention is applicable to outsourcing calculation. Based on the advantage of the bitcoin, honest miners will get corresponding remunerations when completing relevant calculation tasks regardless of how a malicious outsourcer operates.

Owner:XIDIAN UNIV

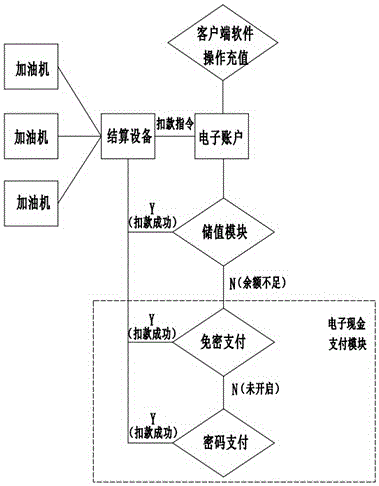

Convenient payment system applied to refueling machines

InactiveCN106408277AImprove pass rateIncrease business volumePayment architectureElectronic identificationNetwork connection

The present invention discloses a convenient payment system applied to refueling machines. The convenient payment system comprises an electronic identifier, a settlement device, client software and server software; the electronic identifier is arranged at one side of the refueling hole of a vehicle; the electronic identifier is an identifier which can be read and written by an electronic device; a built-in serial number arranged in the electronic identifier is corresponding to the electronic account of a user; each electronic account can be associated with a plurality of electronic identifiers; a prepay module and an electronic cash payment module are arranged in the electronic account; the settlement device is connected with the billing systems of the refueling machines through a network or a circuit; and the settlement device is connected with the client software and server software which are set on a mobile device through a network. With the convenient payment system of the invention adopted, refueling and payment can be completed in a few seconds; the owner of the vehicle does not need to get off, and therefore, payment time can be significantly shortened the, vehicle passing rate can be improved, and thus, the business volume of gas stations can be increased; and a refueling operator does not need not move back and forth and return charge, and therefore, the working strength of the refueling operator can be decreased.

Owner:郝军

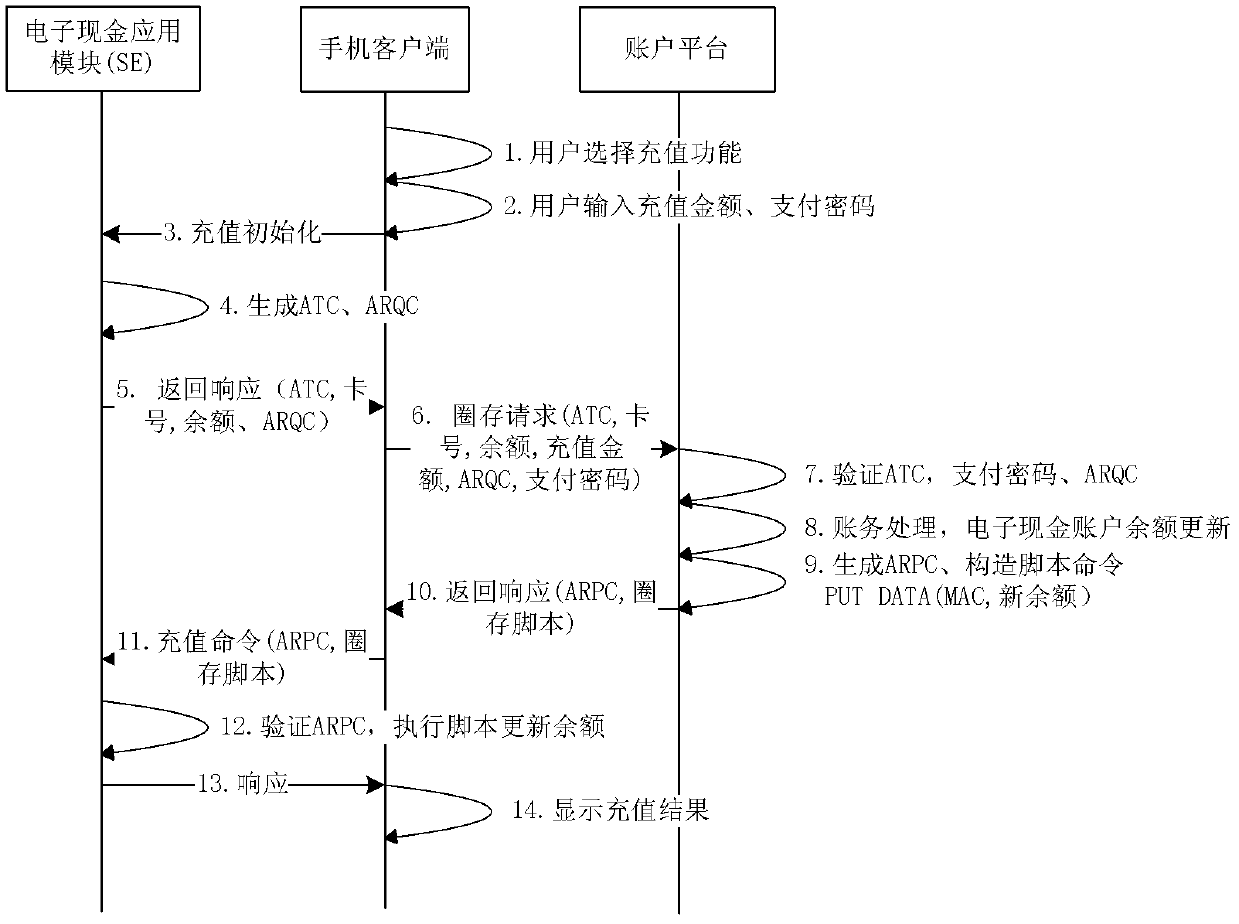

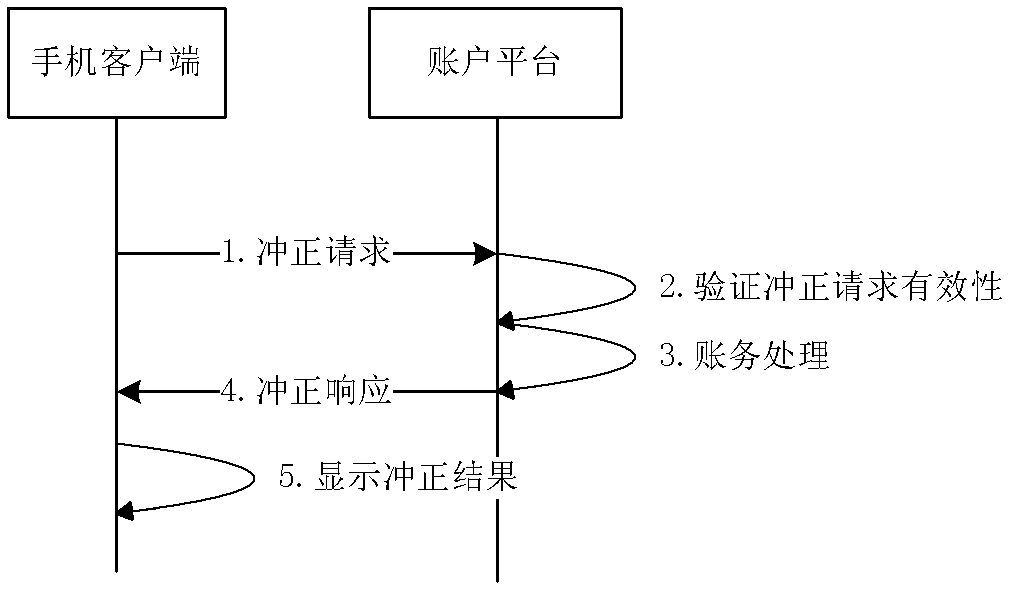

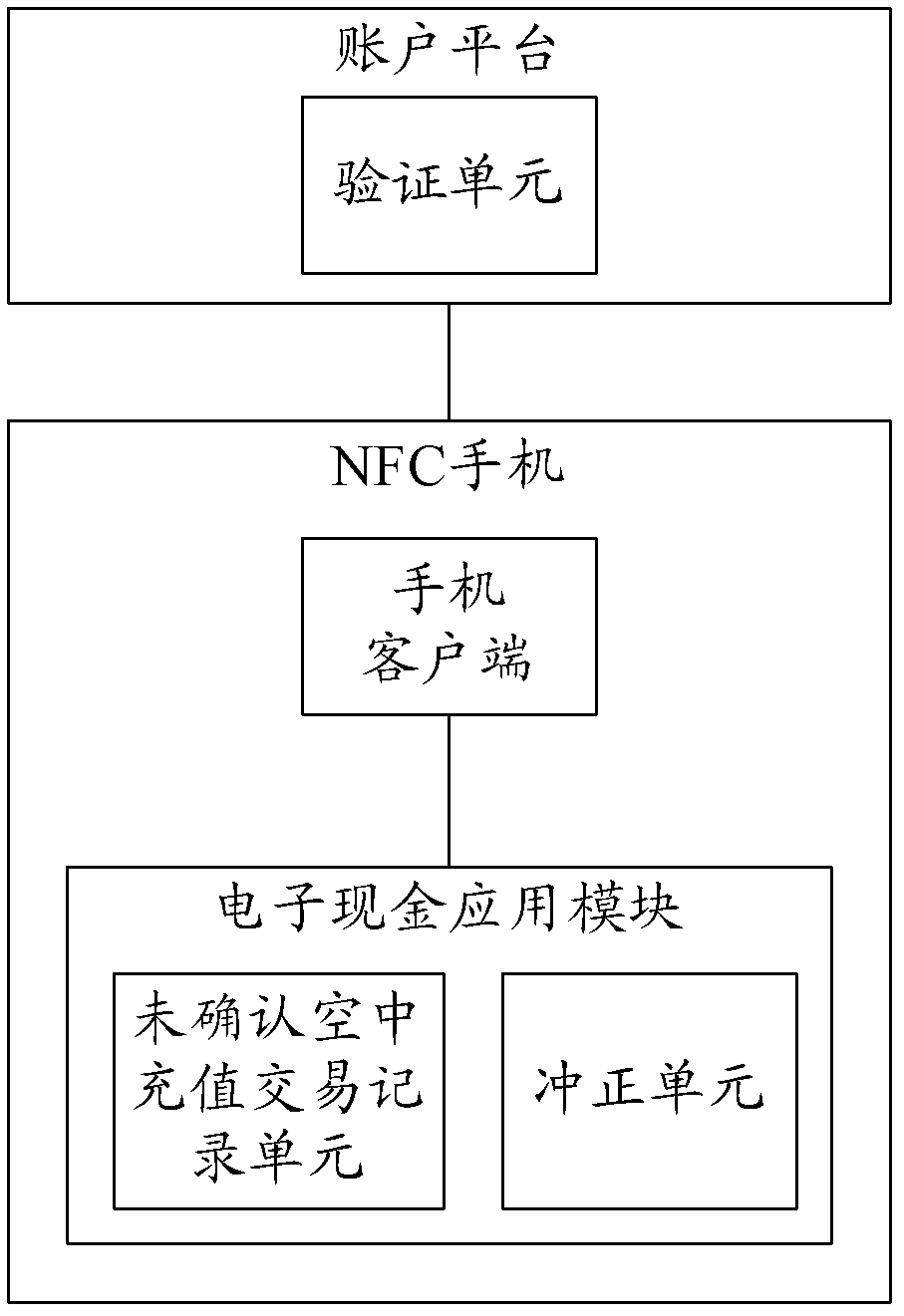

Over-the-air electronic cash loading method, system and device for NFC (near field communication) mobile phone

ActiveCN103310557AEnhanced interactionNo lossCash registersSubstation equipmentElectronic cashComputer terminal

The invention discloses an over-the-air electronic cash loading method, an over-the-air electronic cash loading system and an over-the-air electronic cash loading device for an NFC (near field communication) mobile phone. An unconfirmed over-the-air recharging transaction record is set, and is stored in a card, transaction logic is controlled through the card, interaction between a mobile phone client and the card is added in an over-the-air loading reversing flow, and over-the-air loading reversing logic is controlled mainly through the card. According to the technical scheme, the problems of over-the-air electronic cash loading on the NFC mobile phone and the problem of high tampering rate of over-the-air loading reversing transactions can be solved; and moreover, after an over-the-air loading reversing failure, the unconfirmed over-the-air recharging transaction record can also be read through the mobile phone client or a POS (point-of-sale) terminal, and the loading reversing transactions can be initiated to an account platform, so that the capital loss of a user is avoided.

Owner:CHINA MOBILE COMM GRP CO LTD

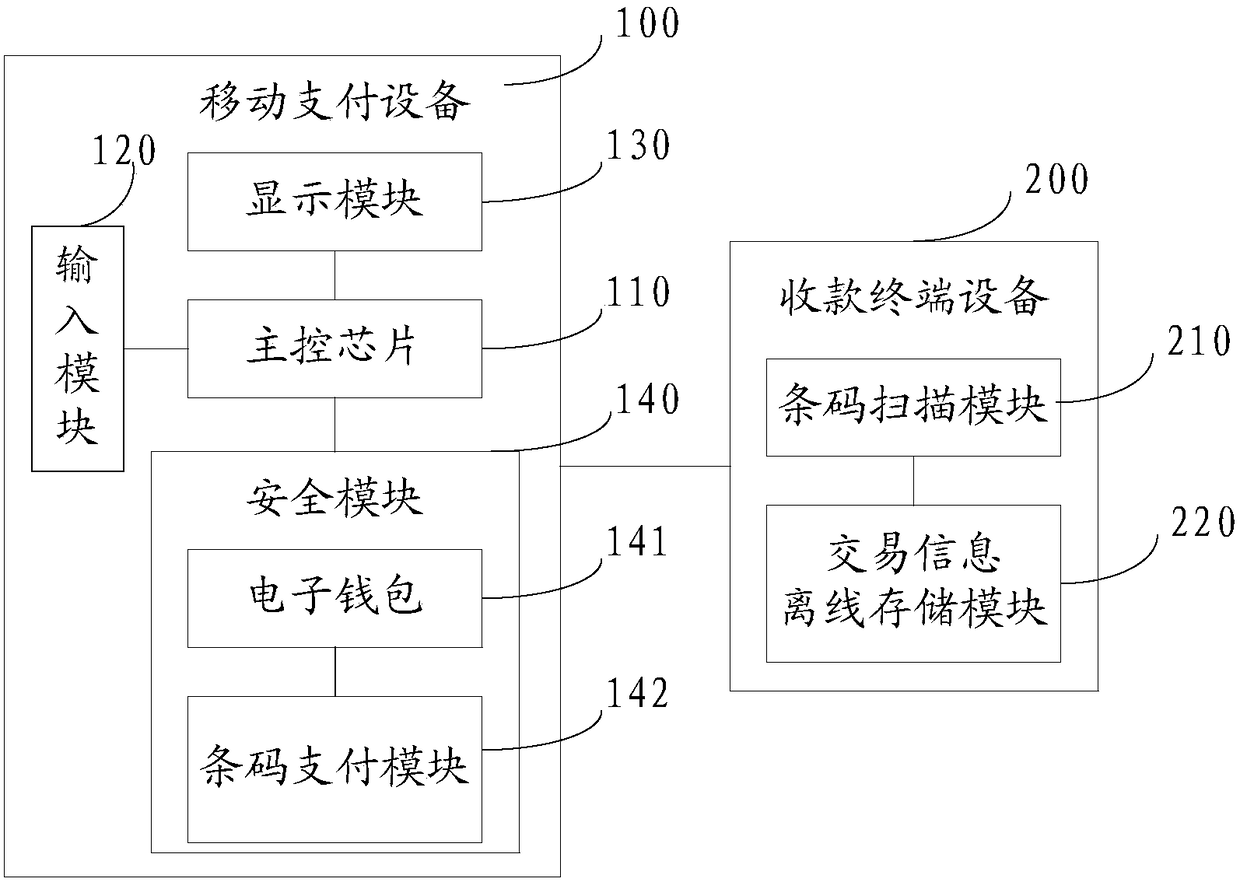

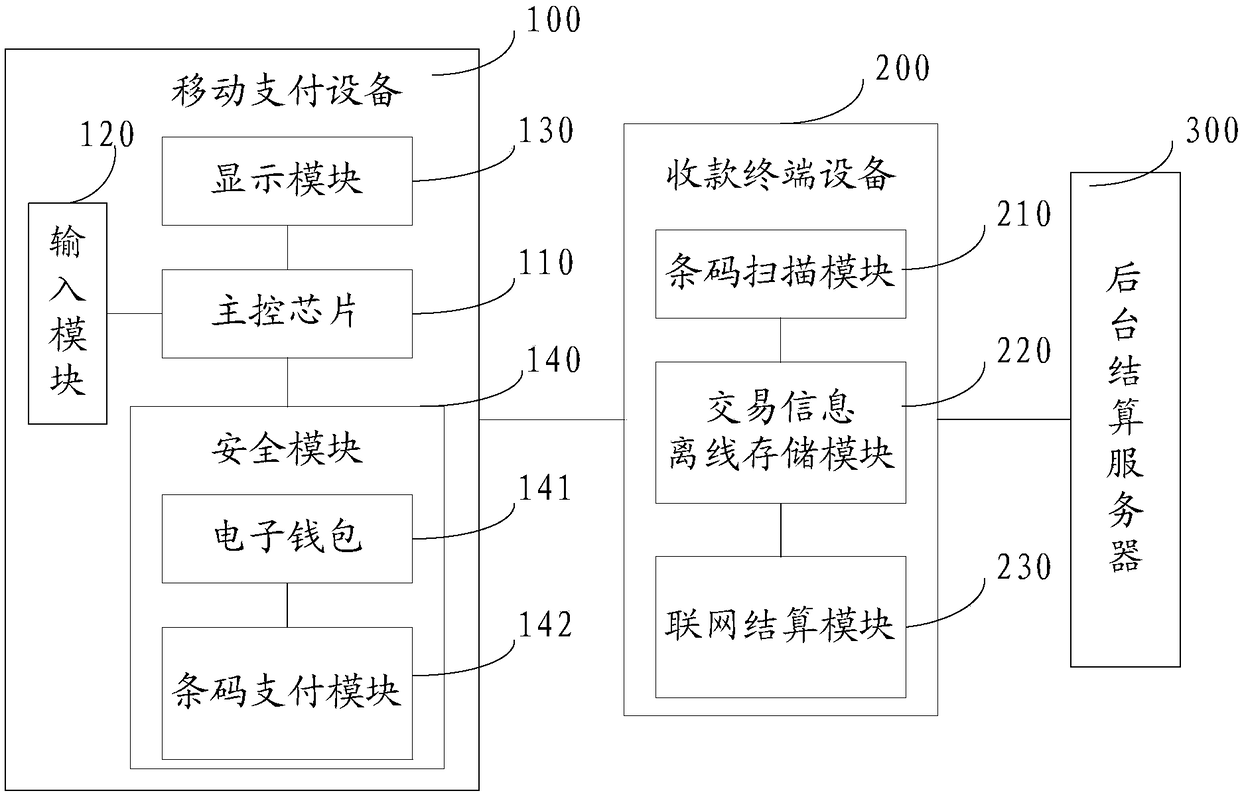

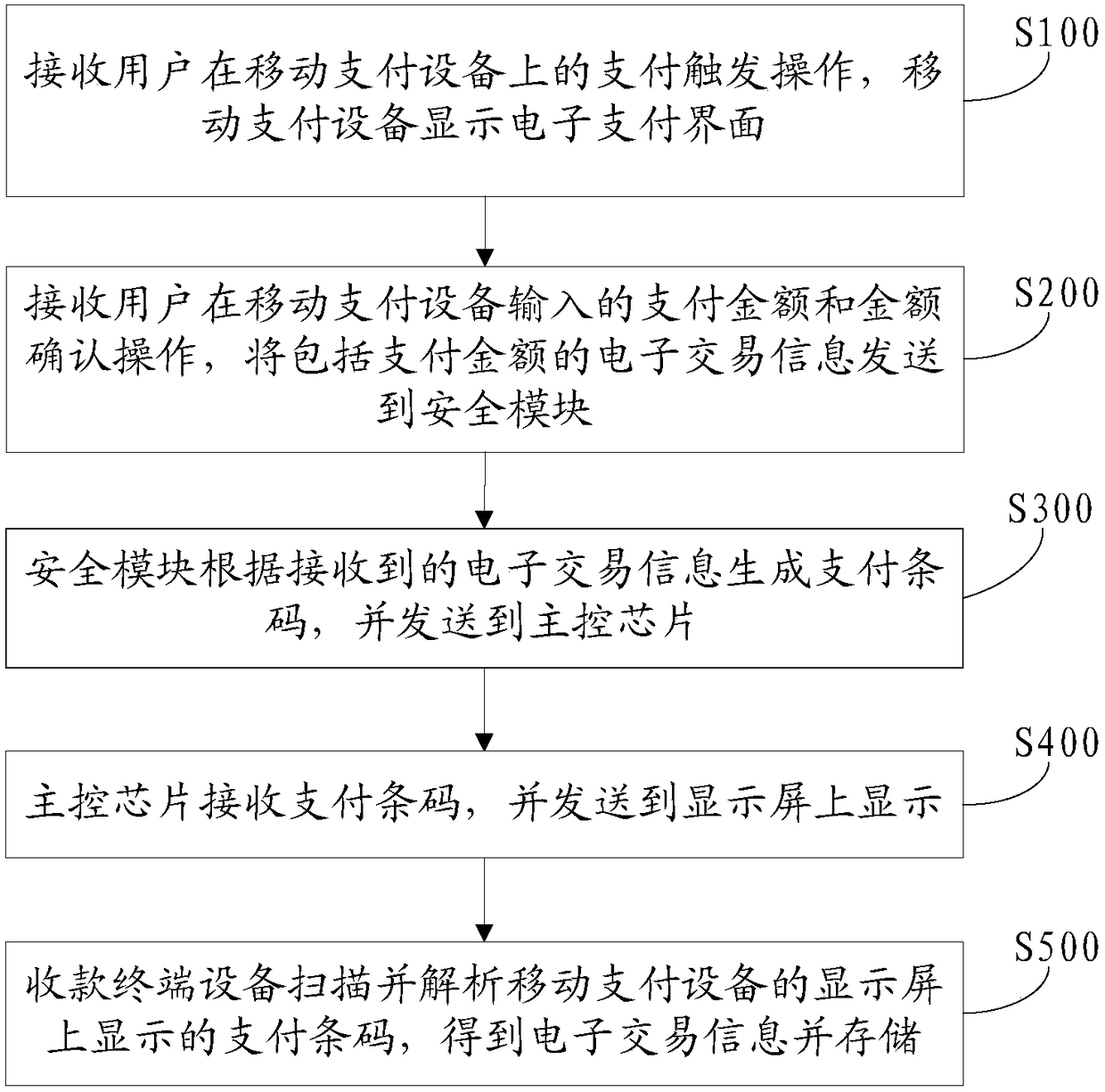

Electronic payment system and method

The embodiment of the invention discloses an electronic payment system and method, and belongs to the technical field of electronic payment. The method comprises the steps of a main control chip receiving the payment amount and the amount confirmation operation input by a user on the mobile payment device, sending the electronic transaction information including the payment amount to a security module, and the security module generating a payment bar code according to the received electronic transaction information and deducting the electronic cash of the payment amount from the electronic wallet, and sending the payment bar code to a main control chip; the main control chip receiving the payment bar code and sending the payment bar code to a display screen for displaying, and collecting terminal equipment scanning and analyzing the payment bar code displayed on the display screen of the mobile payment device to obtain and store the electronic transaction information. The electronic payment system and method can be simultaneously suitable for a payment scene when the user and the commercial tenant are offline simultaneously, extra POS equipment does not need to be installed by a merchant, and the cost is saved.

Owner:WATCHDATA SYST

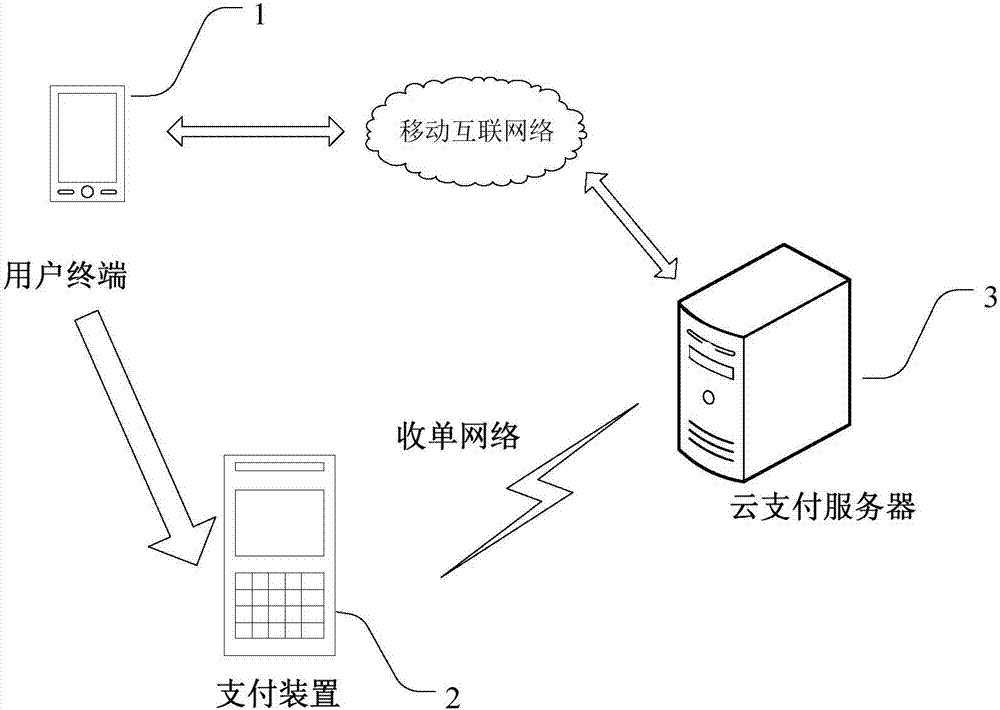

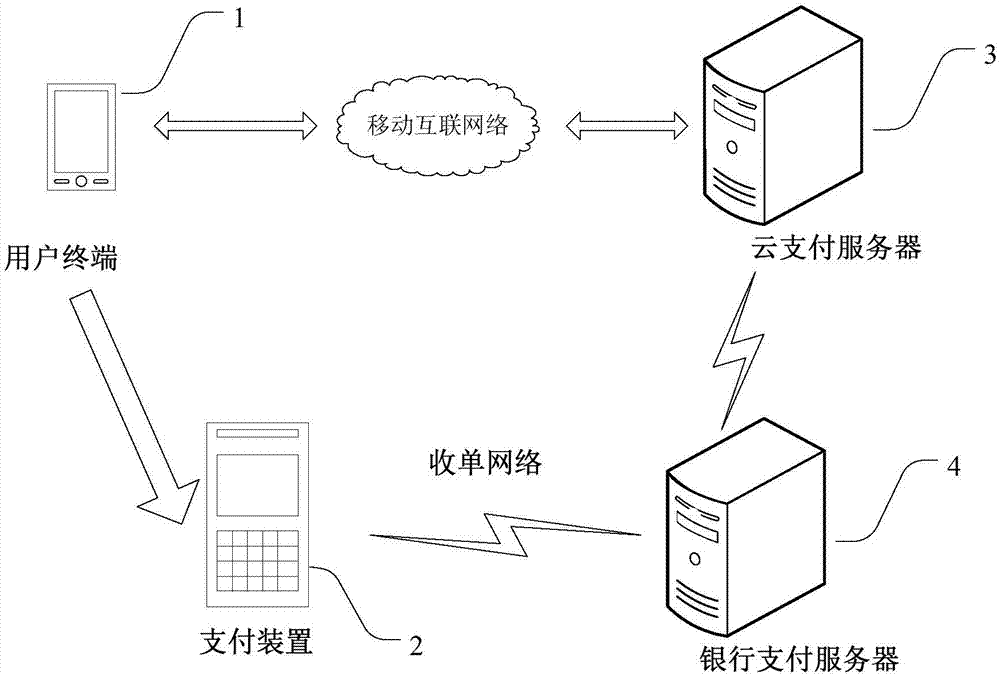

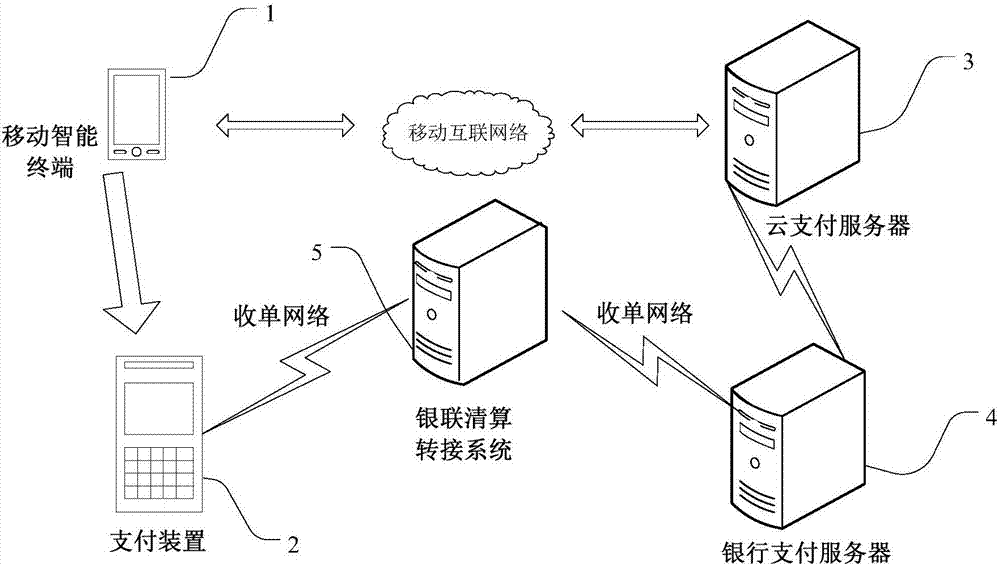

Cloud payment method, system and payment device thereof, and user terminal

PendingCN108009822AEasy to transformLow retrofit costPoint-of-sale network systemsFinancial data processingUser input

The invention relates to the field of financial data processing, and provides a cloud payment method, a system and a payment device thereof, and a user terminal. The cloud payment method comprises thesteps of acquiring to-be-paid sum information which is input by a user; reading stored virtual financial card information, generating a two-dimensional code payment picture according to the sum information, wherein the two-dimensional code payment picture is used for scanning by an external payment device, and the payment device generates payment information and uploads the payment information toa bank payment server for finishing transaction. The cloud payment method, the system and the payment device thereof and the user terminal are advantageous in that low reconstruction cost is realized; the cloud payment method supports offline generation of the payment two-dimensional code and can be used for payment at the position with poor network environment or no network; the generated two-dimensional code picture can be transmitted to other persons for use and is equivalent with an electronic cash voucher, thereby realizing high convenience and preventing transferring cost caused by cashtransferring; the payment amount is input by a user and a condition of more money deduction caused by a trade company input error in code scanning is prevented; and furthermore restriction by carrying an NFC unit on an intelligent device is settled.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

Method and User Device for Management of Electronic Receipts

InactiveUS20090192925A1Digital data processing detailsUser identity/authority verificationUser deviceElectronic cash

Owner:VISA USA INC (US)

Method and Portable Device for Management of Electronic Receipts

A system for managing electronic receipts is provided. According to one aspect, the system includes a portable device, a base device, a user device and an electronic receipts administration system. The electronic receipts administration system provides the base device with the appropriate data to allow the base device to generate, store and manage electronic receipts accordingly. A user uses the portable device to conduct a transaction with the base device. The base device uses a variety of information to generate an electronic receipt for the transaction. Such information includes, for example, information stored on the portable device, information stored locally on the base device and information stored on another device such as an electronic cash register. The electronic receipt is then stored on the portable device. The user device allows the user to subsequently retrieve the electronic receipt for management purposes.

Owner:VISA USA INC (US)

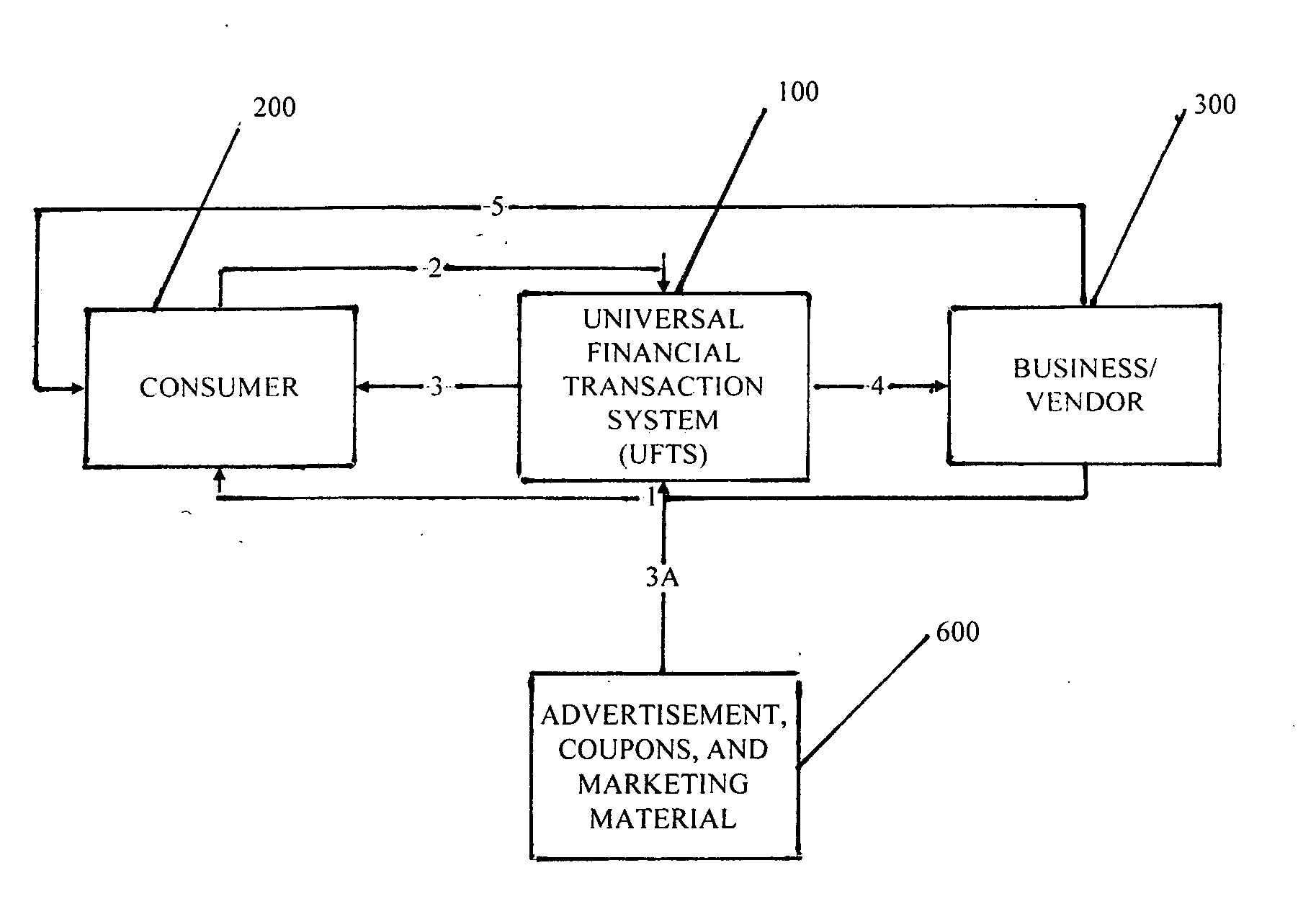

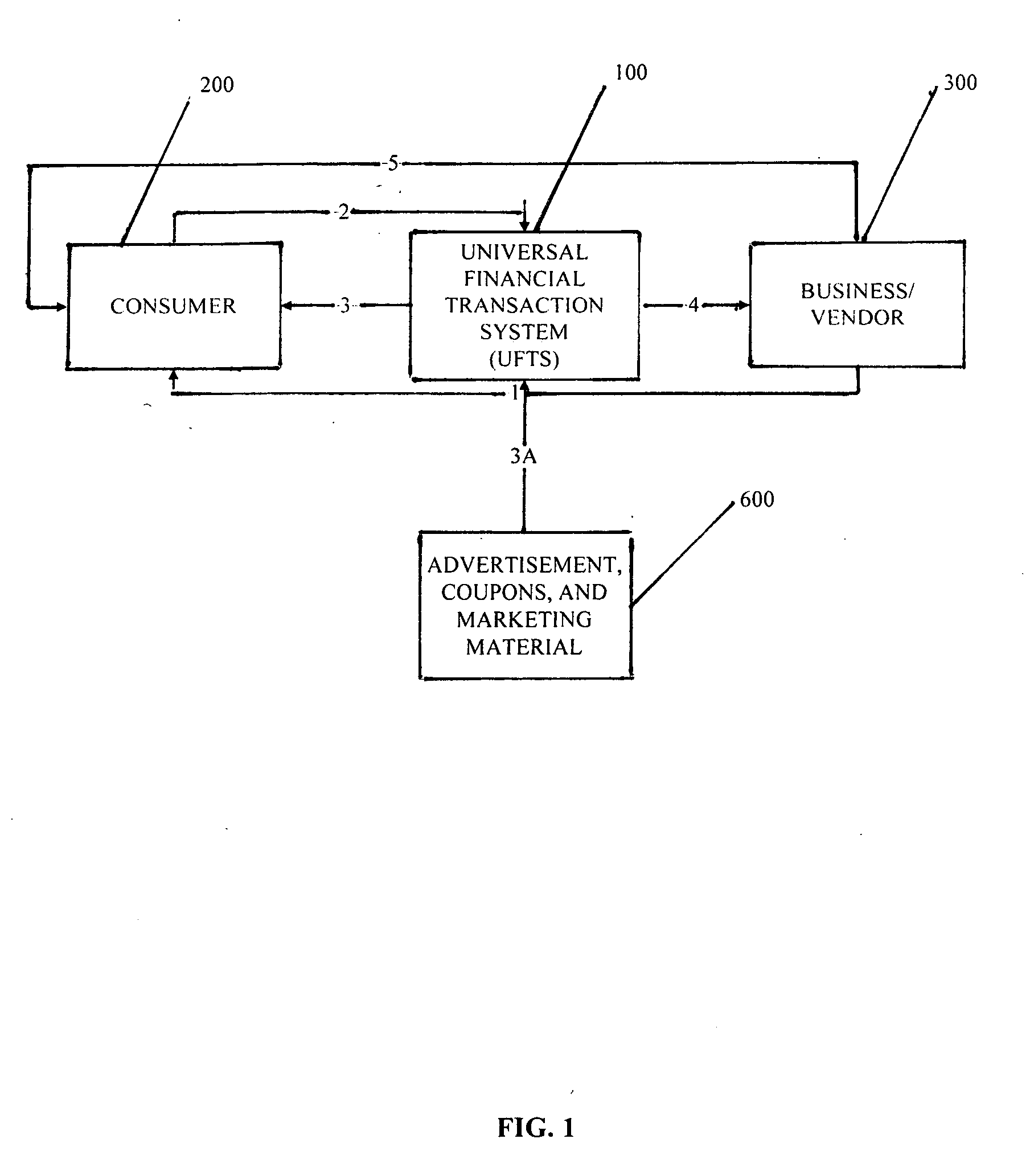

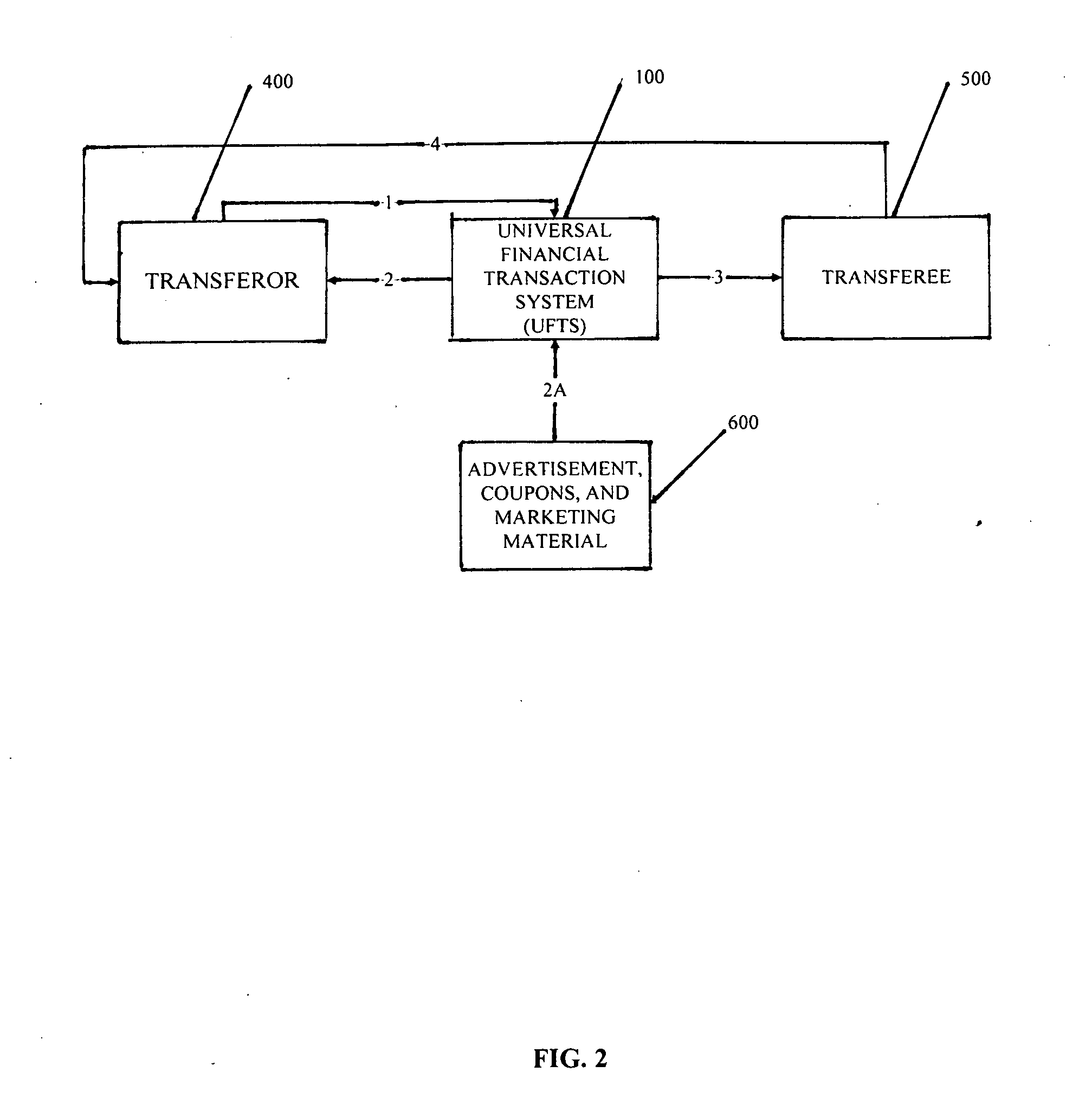

Universal financial transaction system

The Universal Financial Transaction System (UFTS) is an improved electronic payment system which uses encrypted software e to make financial transfers electronically. The UFTS operation is not limited to personal computers like the current online payment system. Moreover, it can be downloaded and operate on any electronic device such as mobile phones, PDA's, pocket computers, personal computer, electronic cash register or point of sale system. This improvement makes the UFTS as user friendly as any credit or debit card and as functional as any online banking system; thus it can be used to purchase items in any retail or online business and it can be used to transfer funds to any individual or entity among United States currency and any foreign currency. The UFTS does not charge the end-user for the financial transaction instead it generate its own revenue through transmittal of advertisement to the user's electronic device.

Owner:DORO JOSHUA A

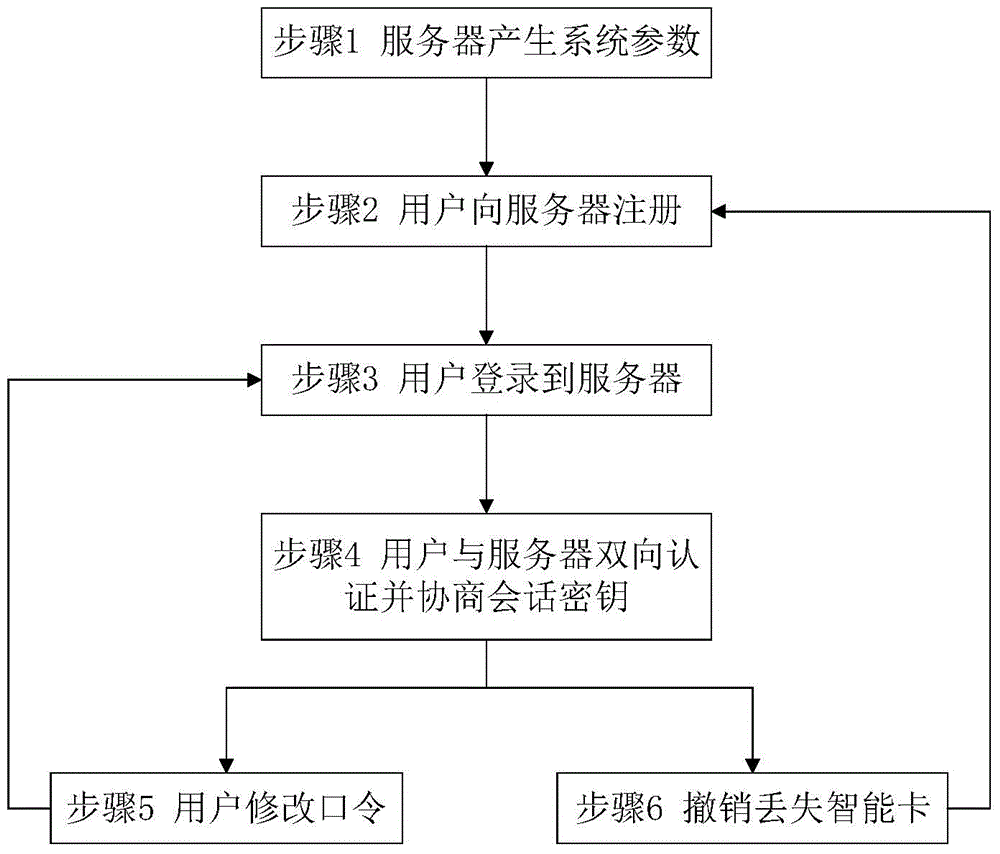

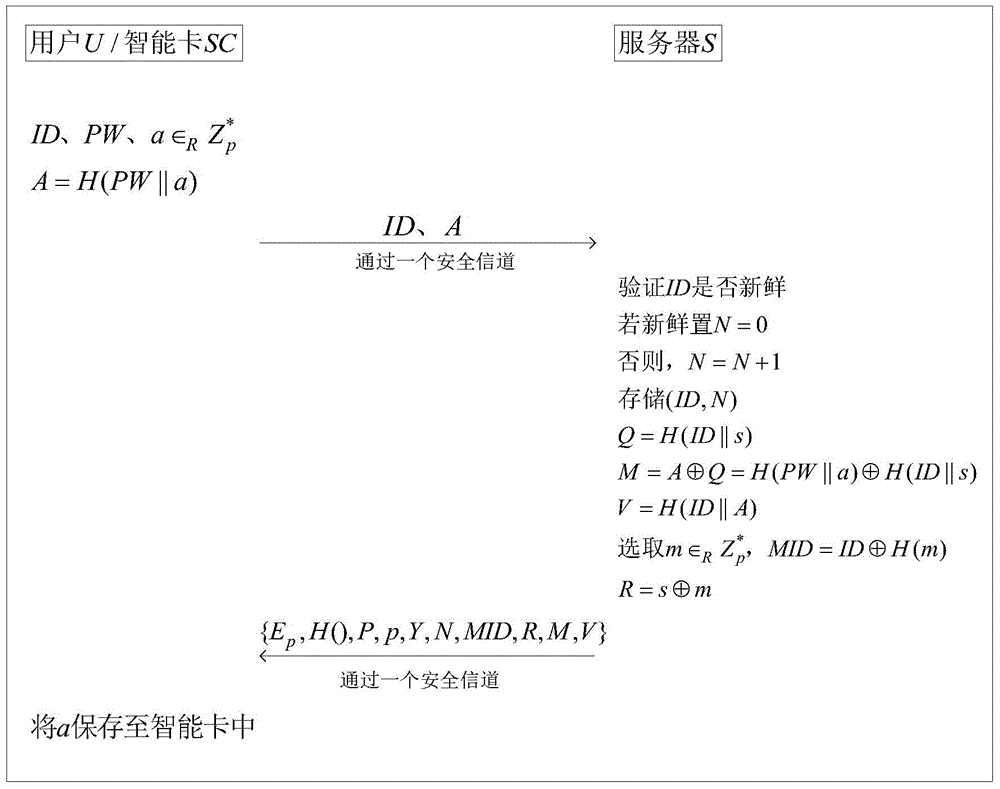

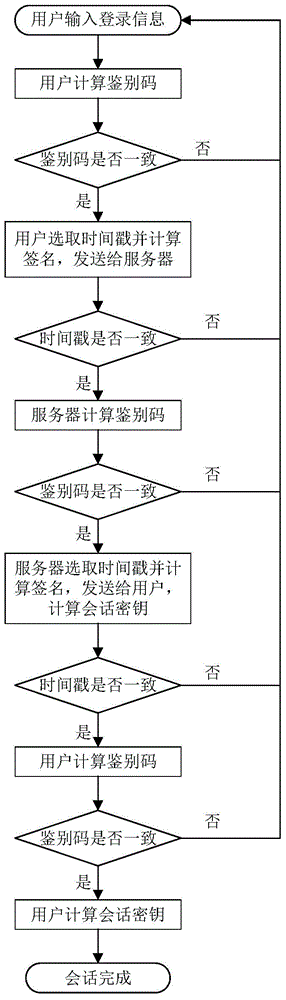

Remote authentication protocol method based on password and intelligent card

ActiveCN104901809AEnhanced anonymityReach deliveryUser identity/authority verificationArray data structurePassword

The invention provides a remote authentication protocol method based on password and an intelligent card, and belongs to the field of information safety. The protocol employs an optimized elliptical curve algorithm, a counting set and authentication codes are embedded, password can be modified, and the lost intelligent card can be canceled. The anonymity of a user is ensured, the method is safe and efficient, mutual authentication and negotiation of session key of the user are realized via twice interaction, and the method is suitable for remote authentication systems as e-cash, online education and remote medicine.

Owner:BEIHANG UNIV

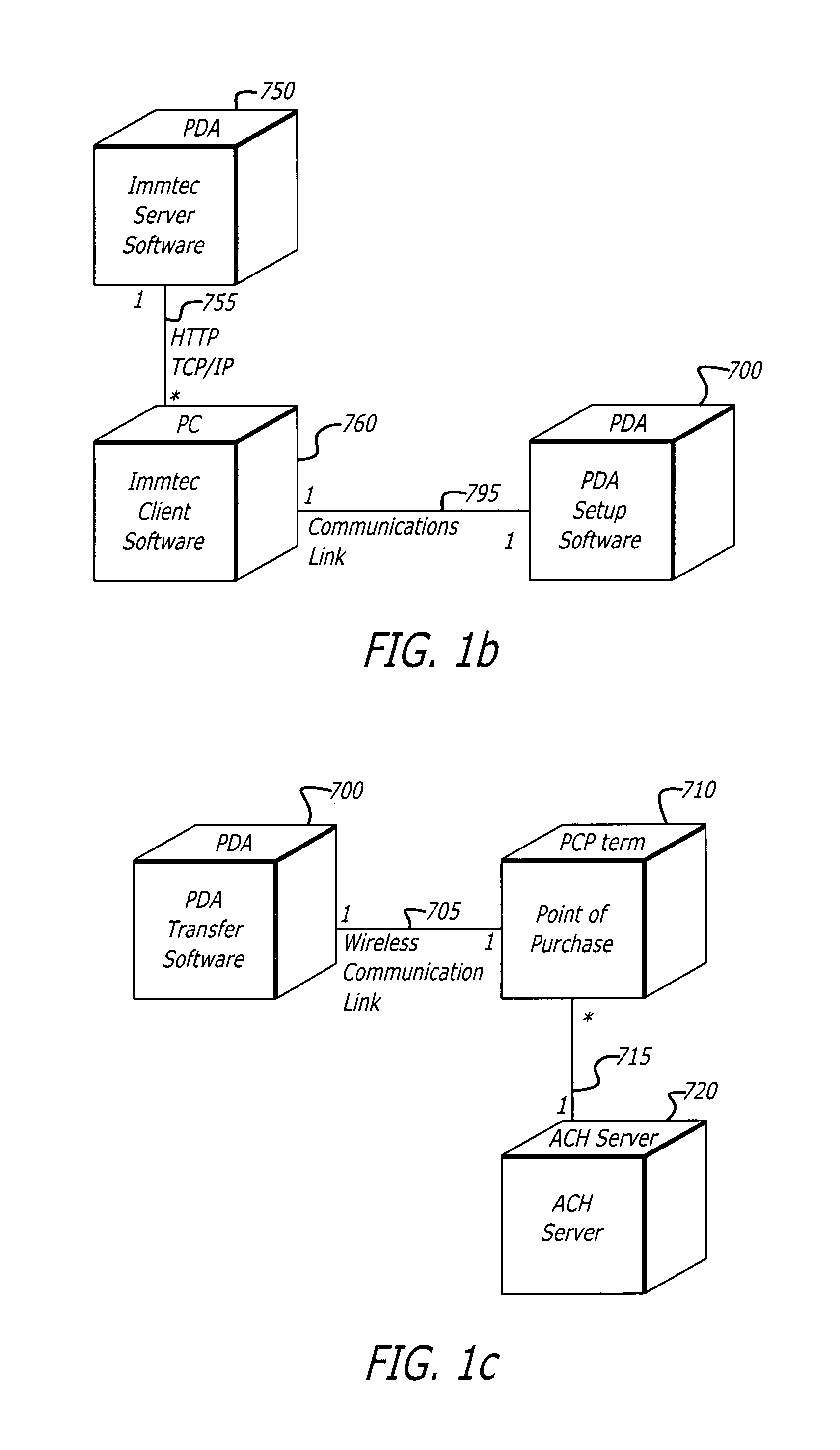

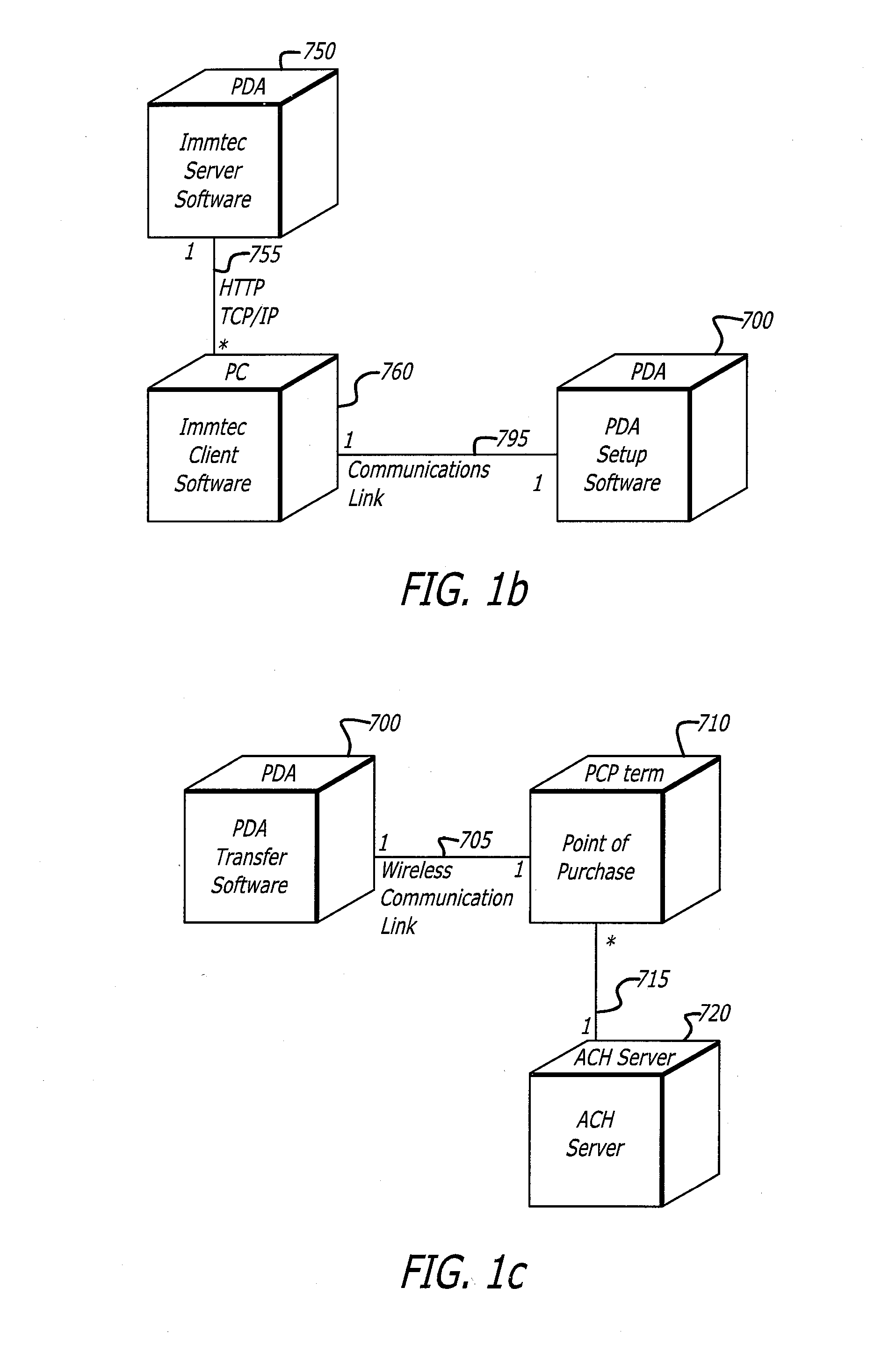

Apparatus, systems and methods for wirelessly transacting financial transfers, electronically recordable authorization transfers, and other information transfers

The present invention provides apparatus, systems and methods to wirelessly pay for purchases, electronically interface with financial accounting systems, and electronically record and wirelessly communicate authorization transactions using Personal Digital Assistant (“PDA”) (also referred to as Personal Intelligent Communicators (PICs), and Personal Communicators), palm computers, intelligent handheld cellular and other wireless telephones, and other personal handheld electronic devices configured with infrared or other short range data communications (for referential simplicity, such devices are referred to herein as “PDA's”). The present invention further provides apparatus, firmware, software programs and computer-implemented methods for making service and / or sale service charge payments for credit card charges, debit card charges, electronic cash transfers, ticket and other like financial transactions and for other types of transactions, such as for electronic coupons, where the amount of the transaction is for a small amount of money, such as, for example, less than $5.00.

Owner:SENTEGRA

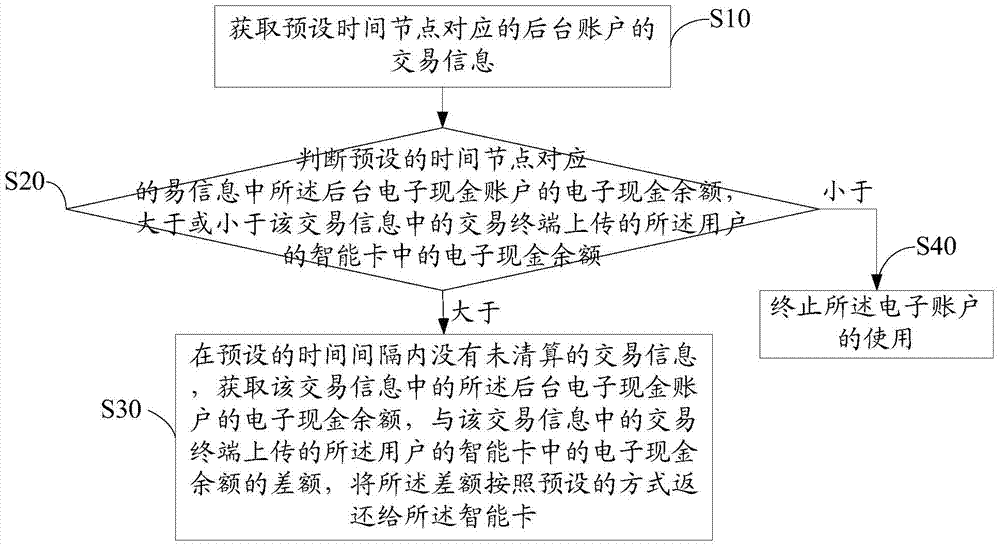

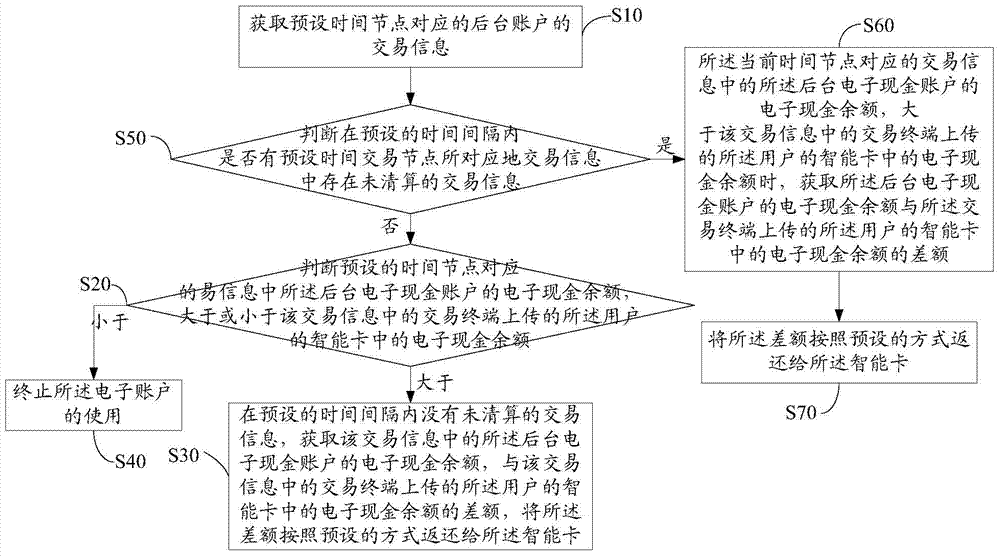

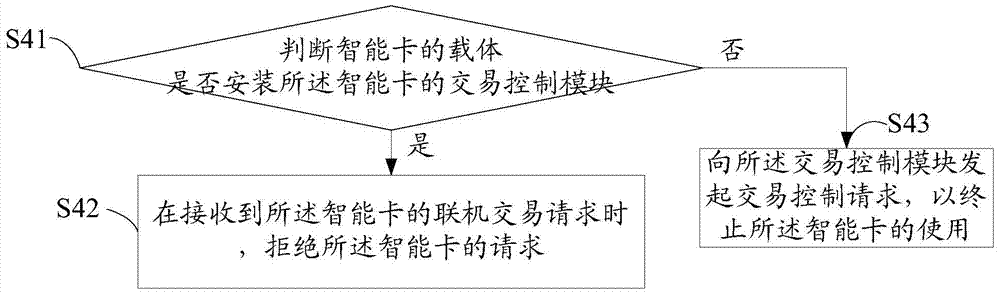

Electronic cash liquidation method and device

InactiveCN103489099ATimely processingEasy to handlePayment architectureElectronic cashComputer science

The invention relates to an electronic cash liquidation method and device. The electronic cash liquidation method comprises the steps of obtaining trade information, corresponding to a preset time node, of a background electronic cash account, if the electronic cash balance of the background electronic cash account is larger than the electronic cash balance uploaded by a trade terminal, obtaining a difference of the electronic cash balance of the background electronic cash account and the electronic cash balance uploaded by the trade terminal, and returning the difference to the electronic cash account in a preset mode, and if the electronic cash balance of the background electronic cash account is smaller than the electronic cash balance uploaded by the trade terminal, stopping using the electronic cash account. Therefore, the problems, such as deduction failures, recharging failures and recharging cheats, of a user can be found in the trade process when liquidation is carried out, processing can be done in time, the trade failure processing process is simple and rapid, and inconvenience caused by locking of the electronic cash account is avoided, and user experience and convenience are greatly improved.

Owner:CHINA MERCHANTS BANK

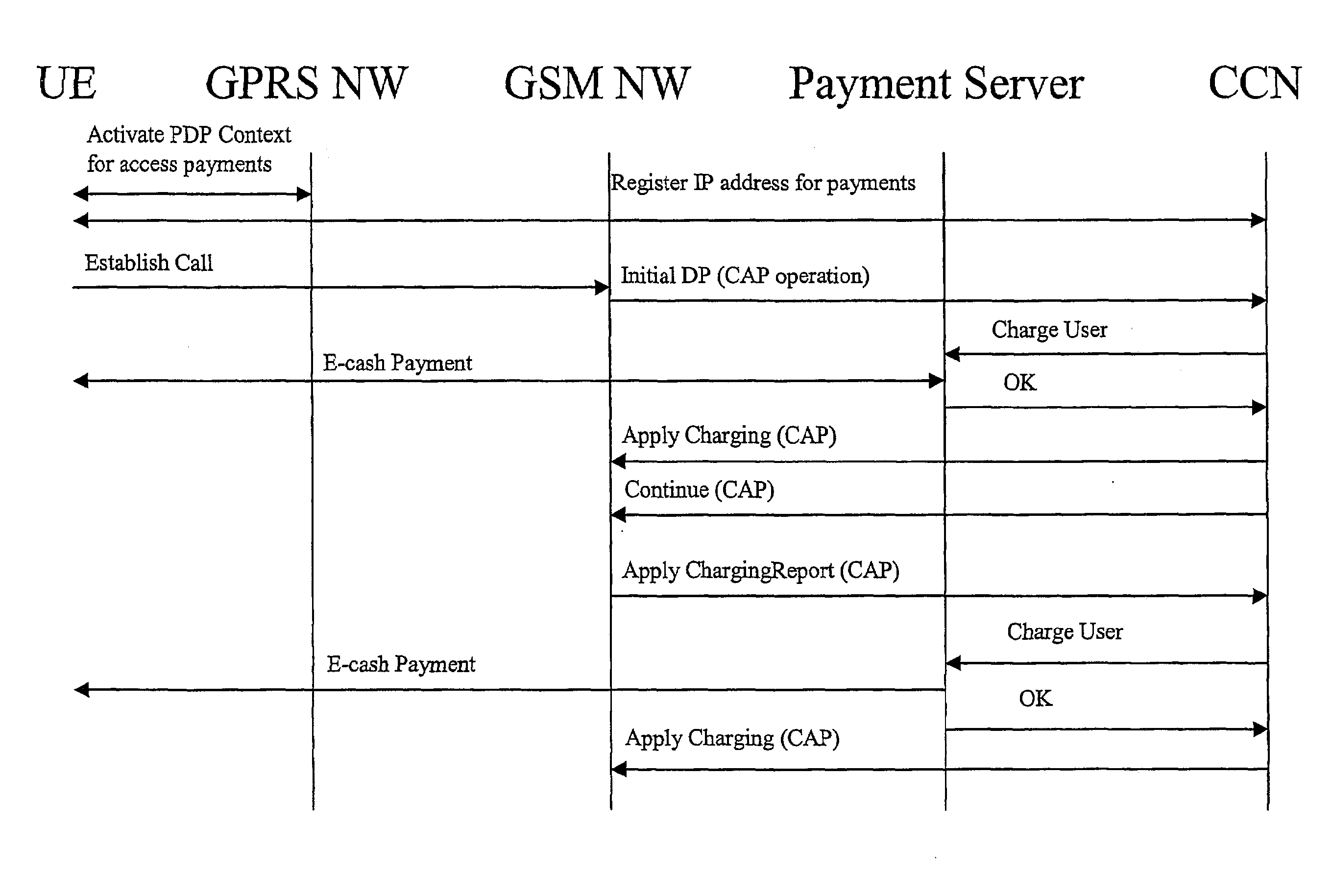

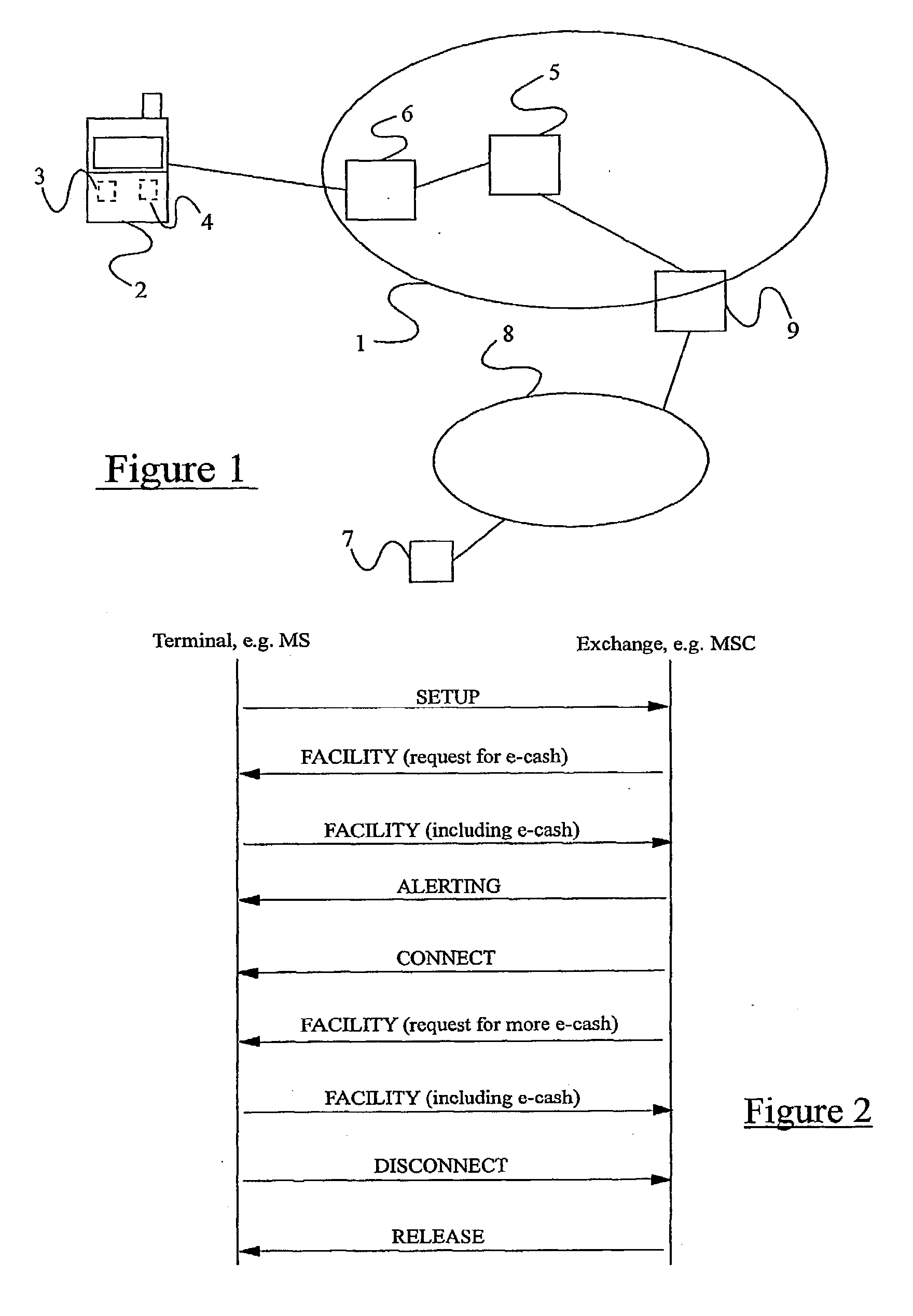

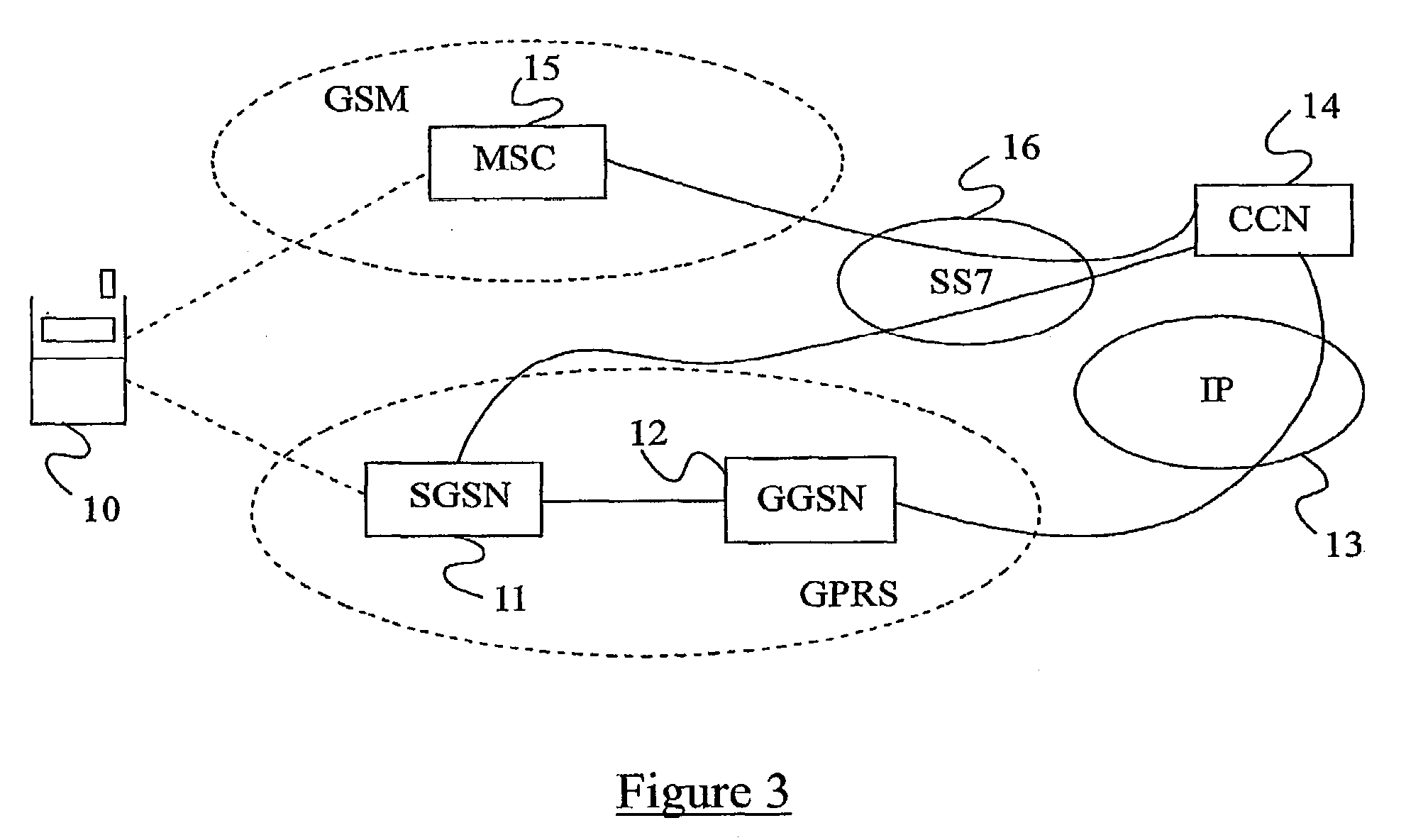

Paying for telephone services using electronic cash

InactiveUS20030177088A1FinancePrepayment with on-line account/card rechargingTelecommunications networkElectronic cash

A method of using electronic cash to pay for services obtained from or via a telecommunications network 1. The method comprises storing electronic cash in a memory 3 of or coupled to a user terminal 2, extracting electronic cash from said memory 3 and sending the extracted cash to the telecommunications network 1 inside a signalling message sent over a signalling channel or using a dedicated PDP context.

Owner:TELEFON AB LM ERICSSON (PUBL)

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com