Patents

Literature

266 results about "Mobile banking" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Mobile banking is a service provided by a bank or other financial institution that allows its customers to conduct financial transactions remotely using a mobile device such as a smartphone or tablet. Unlike the related internet banking it uses software, usually called an app, provided by the financial institution for the purpose. Mobile banking is usually available on a 24-hour basis. Some financial institutions have restrictions on which accounts may be accessed through mobile banking, as well as a limit on the amount that can be transacted. Mobile banking is dependent on the availability of an internet or data connection to the mobile device.

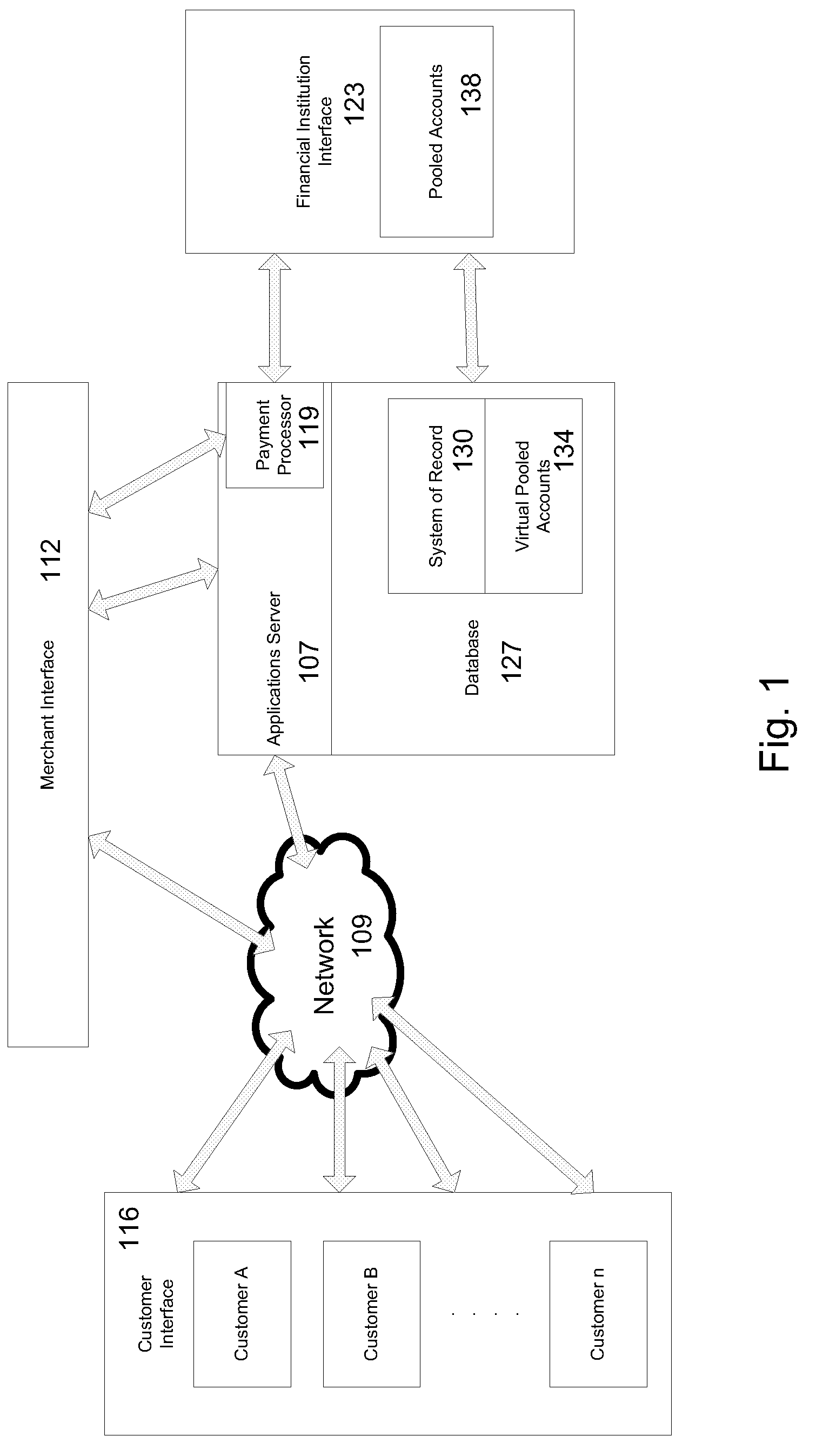

Virtual Pooled Account for Mobile Banking

InactiveUS20090119190A1Reduce settlementReduce operating costsComplete banking machinesFinanceOperational costsSimulation

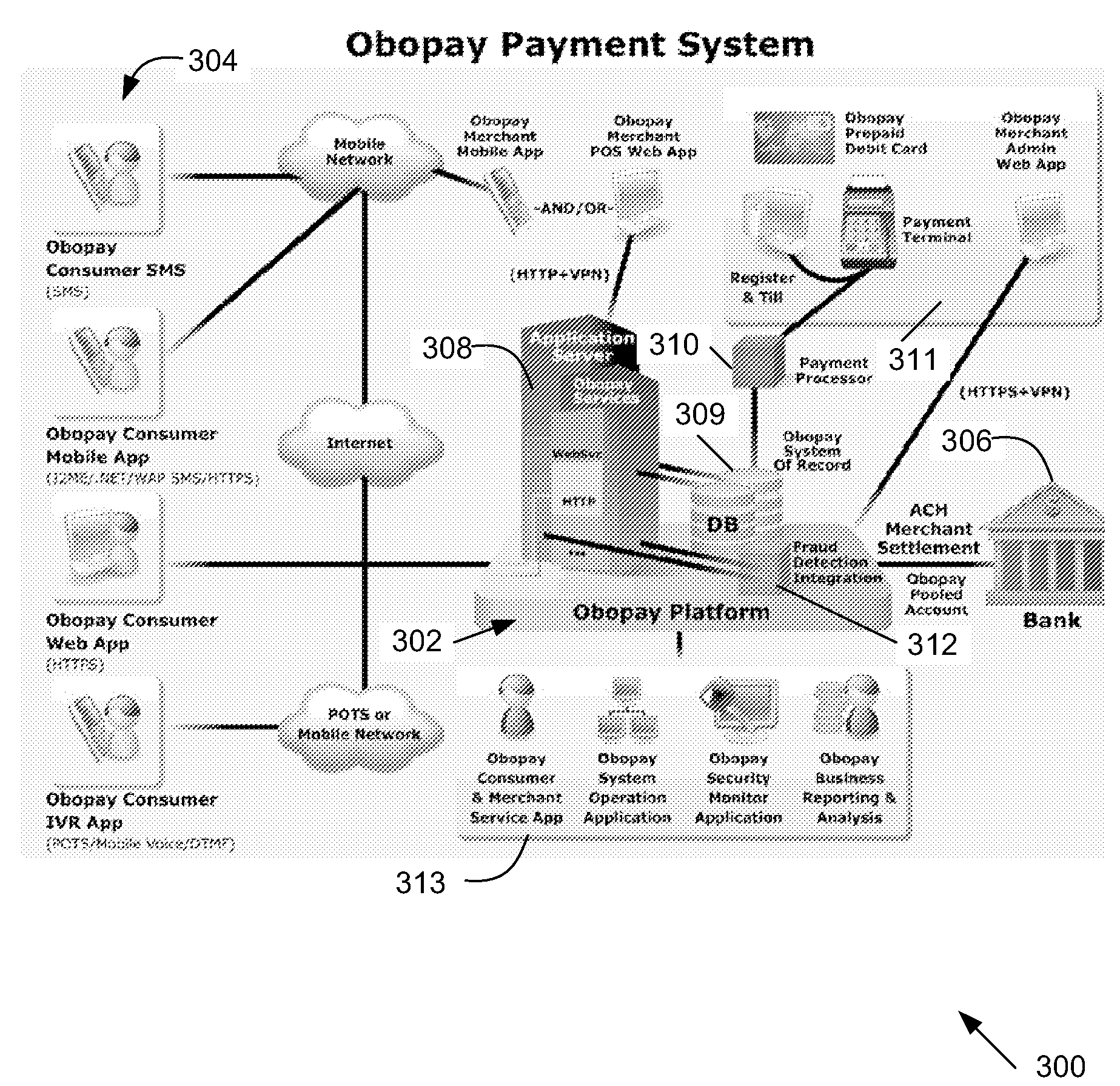

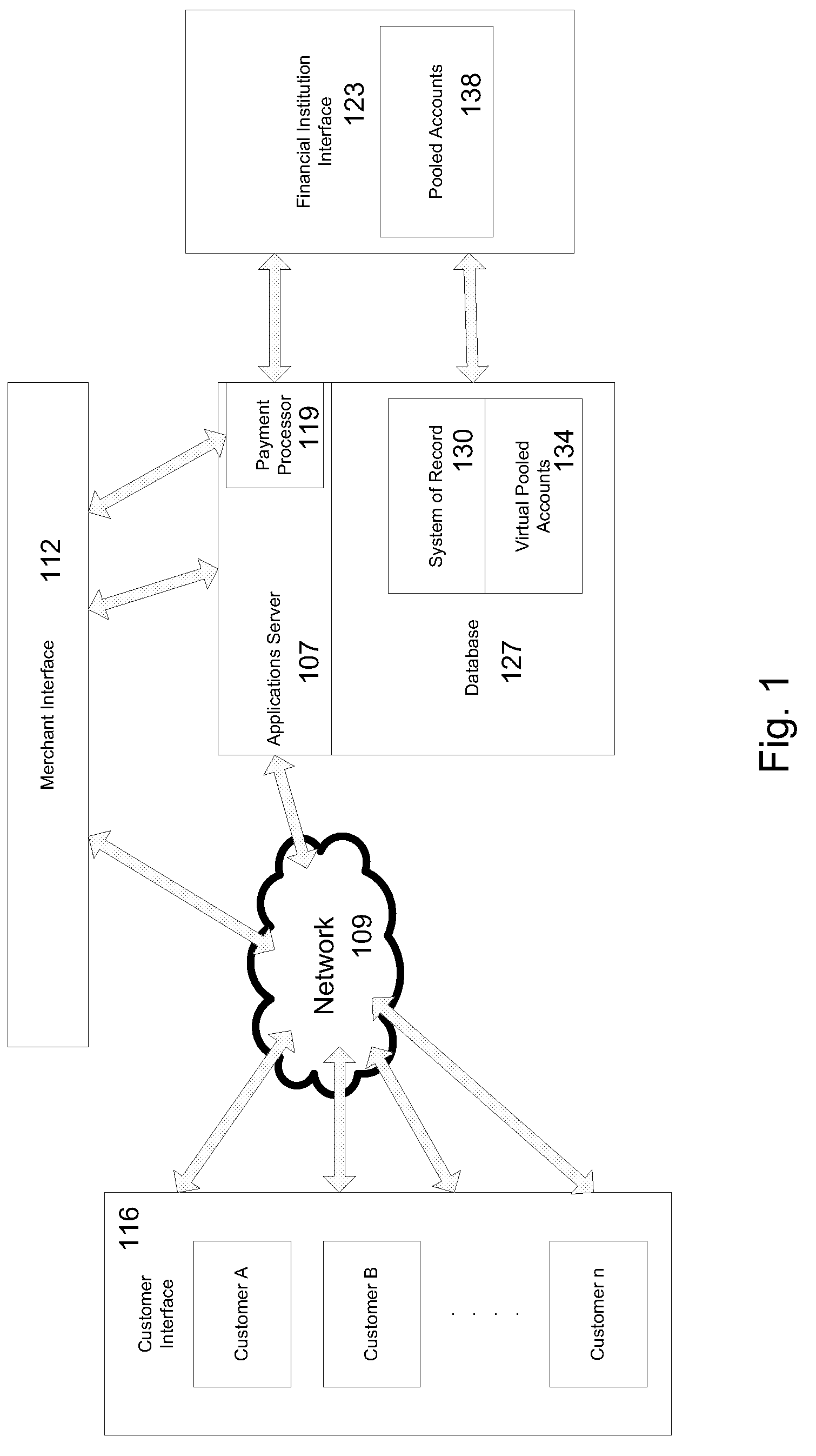

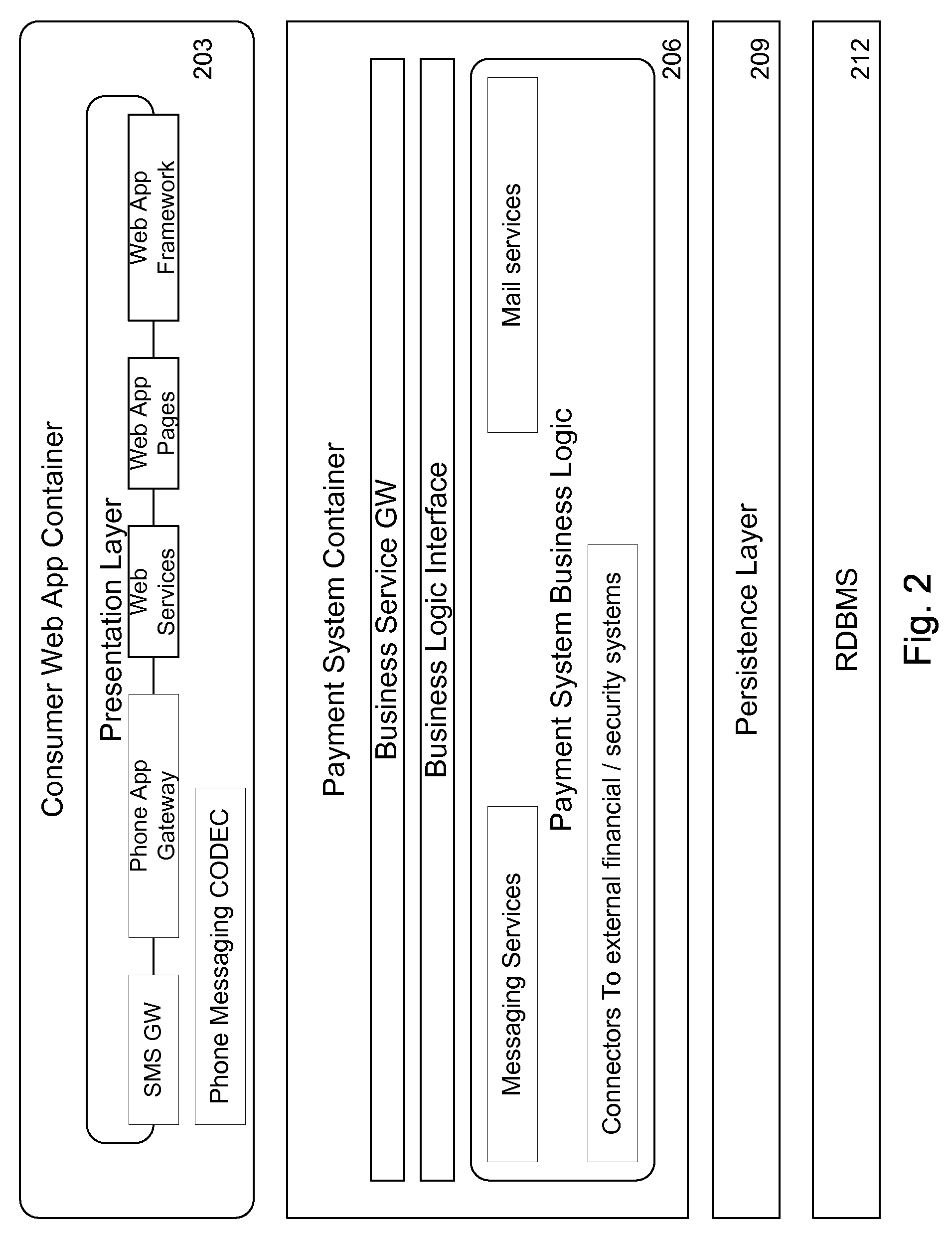

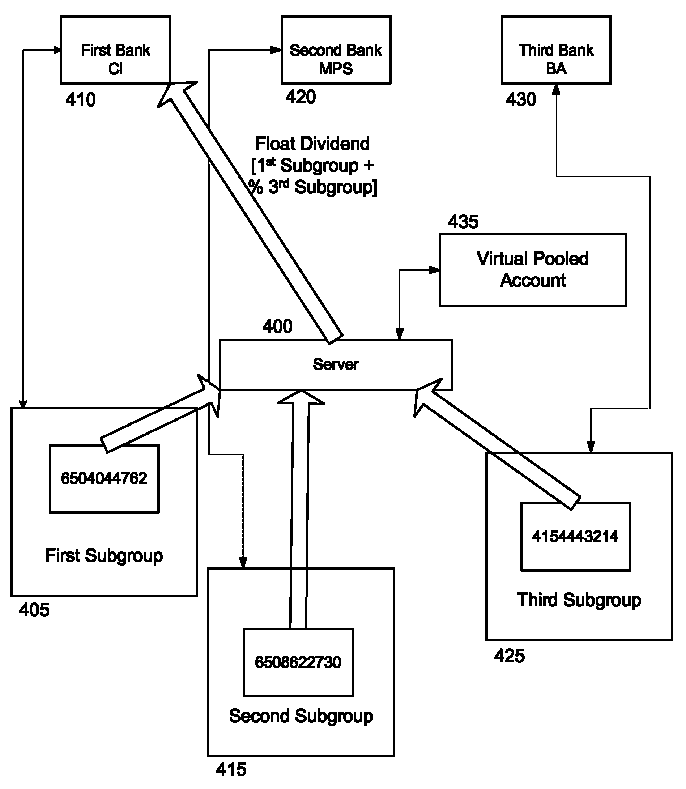

A virtual pooled account is used in operating a system having multiple financial partners. In a specific implementation, the system is a mobile banking system. Instead of maintaining separate general ledgers for each financial institution, the system will keep one general virtual pooled account. This will reduce the settlement and operational costs of the system. The owner of the virtual pooled account will receive the float on the virtual pooled account, and this float will be distributed to the multiple financial partners according to a formula.

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

Virtual pooled account for mobile banking

ActiveUS7873573B2Reduce settlement and operational cost of systemThe process is simple and fastComplete banking machinesFinanceOperational costsSimulation

A virtual pooled account is used in operating a system having multiple financial partners. In a specific implementation, the system is a mobile banking system. Instead of maintaining separate general ledgers for each financial institution, the system will keep one general virtual pooled account. This will reduce the settlement and operational costs of the system. The owner of the virtual pooled account will receive the float on the virtual pooled account, and this float will be distributed to the multiple financial partners according to a formula.

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

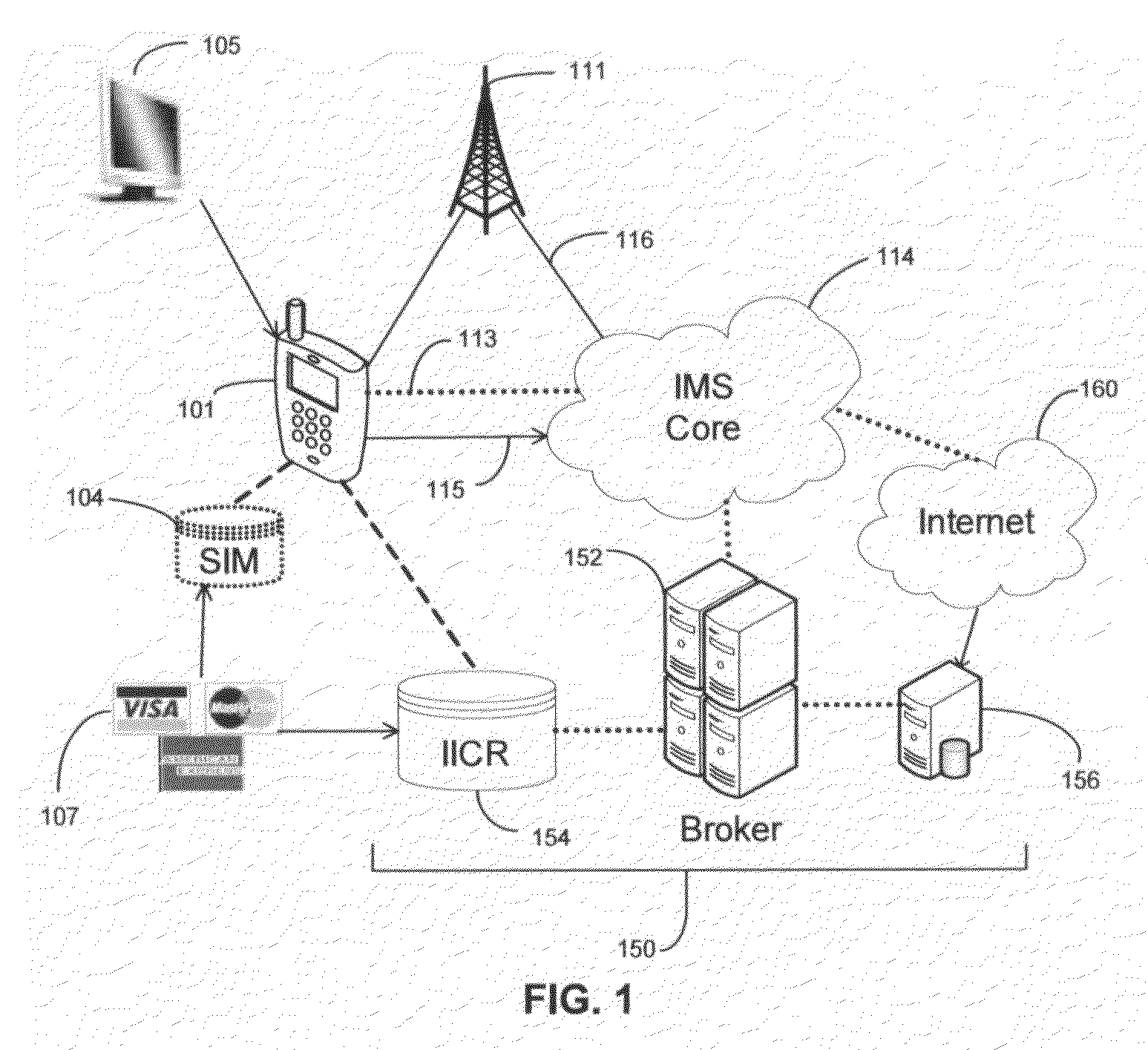

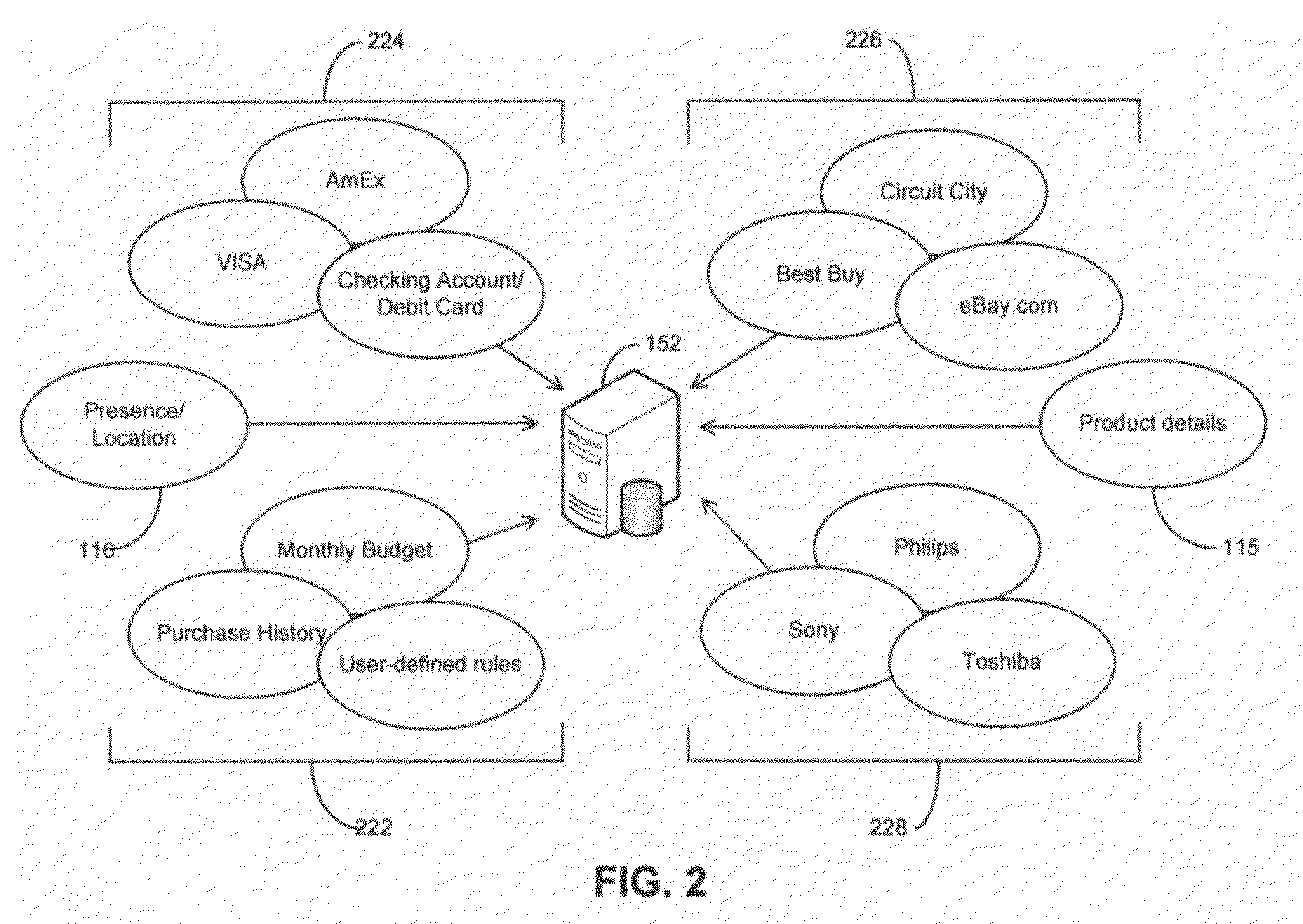

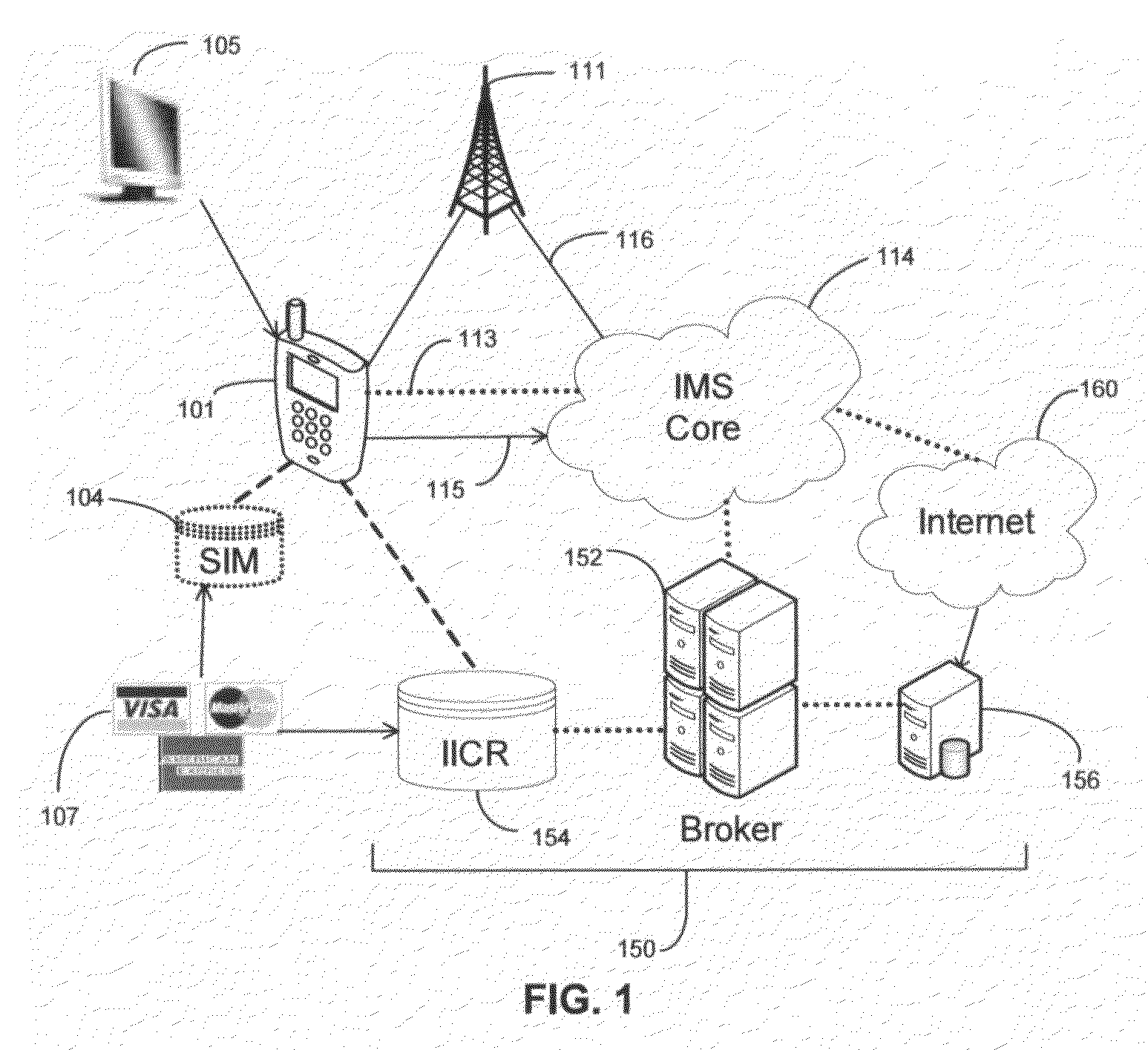

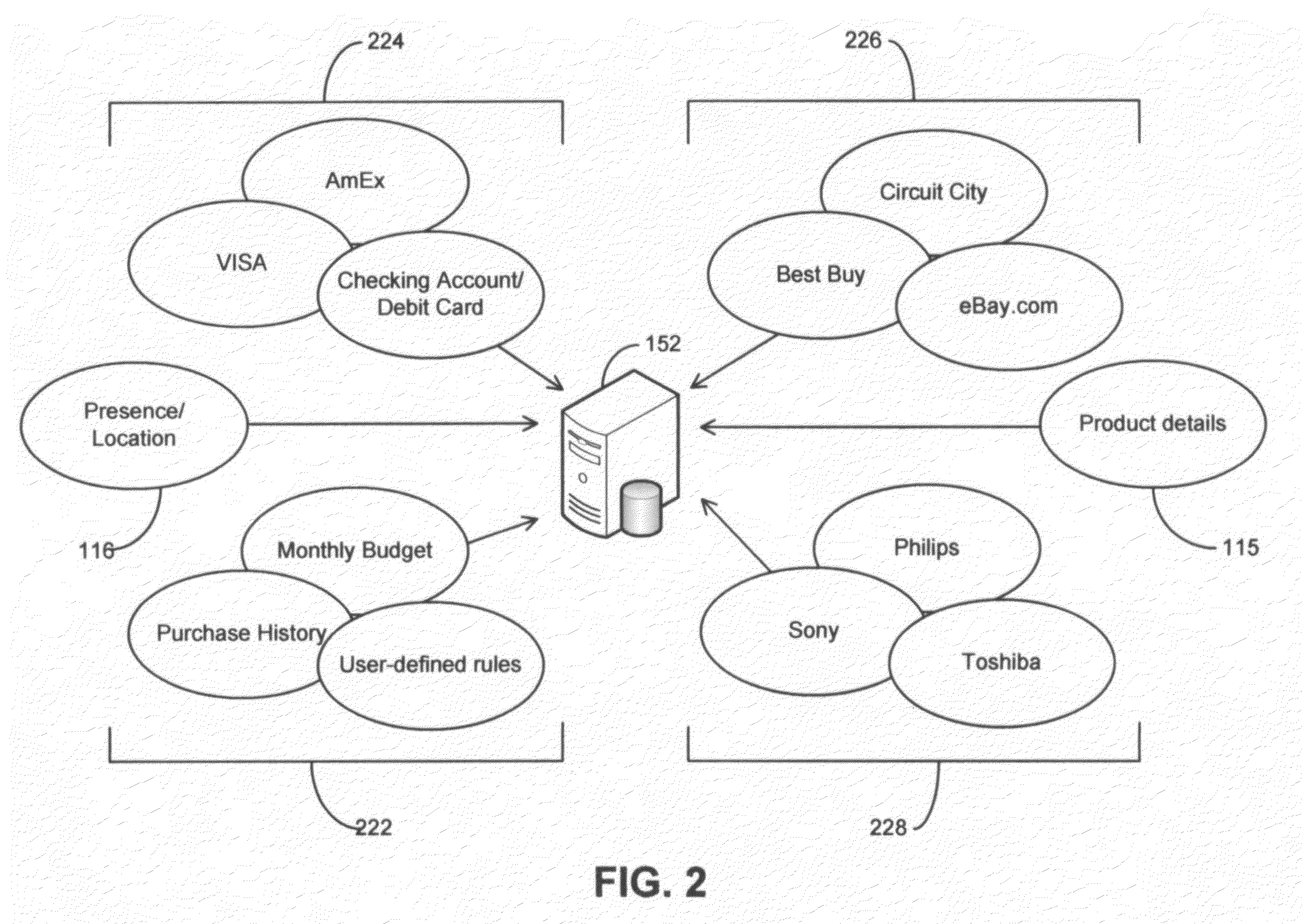

Systems and methods for profile-based mobile commerce

ActiveUS20080242274A1Minimize lagGreat dealFinanceSpecial service for subscribersSystems analysisFinancial transaction

The invention discloses systems and methods for integrating Mobile Commerce applications with dynamically generated user profiles. A profiling engine collects and stores information regarding a mobile subscriber's usage of Mobile Banking, Mobile Payment, and Mobile Brokerage, and stores the information in a profile. A Dynamic Event Server Subsystem comprising a Mobile Broker analyzes patterns in the subscriber's usage of these applications. The mobile broker can thus provide intelligent feedback regarding purchases and financial transactions back to the applications and to the subscriber. This feedback is provided in real time.

Owner:CINGULAR WIRELESS II LLC

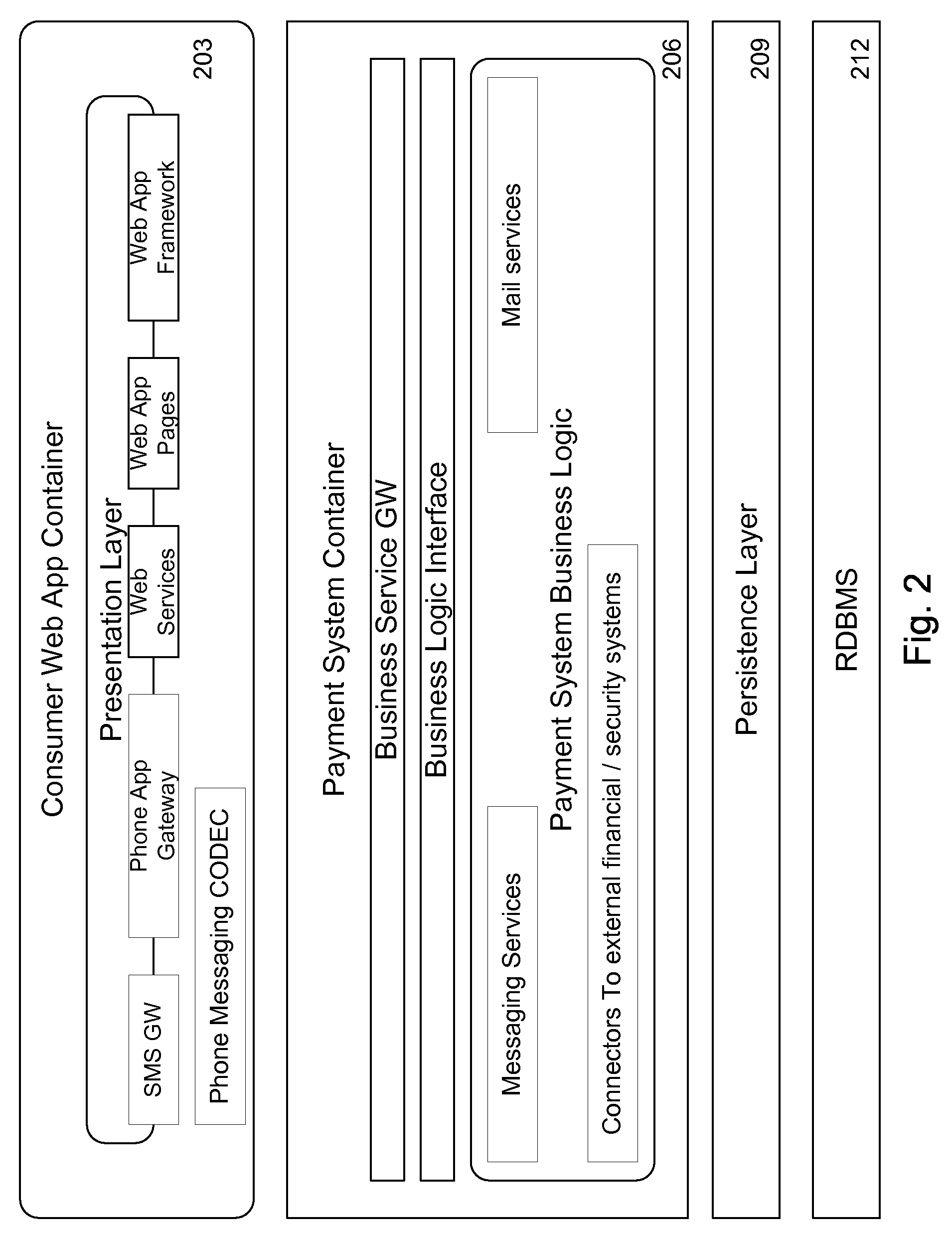

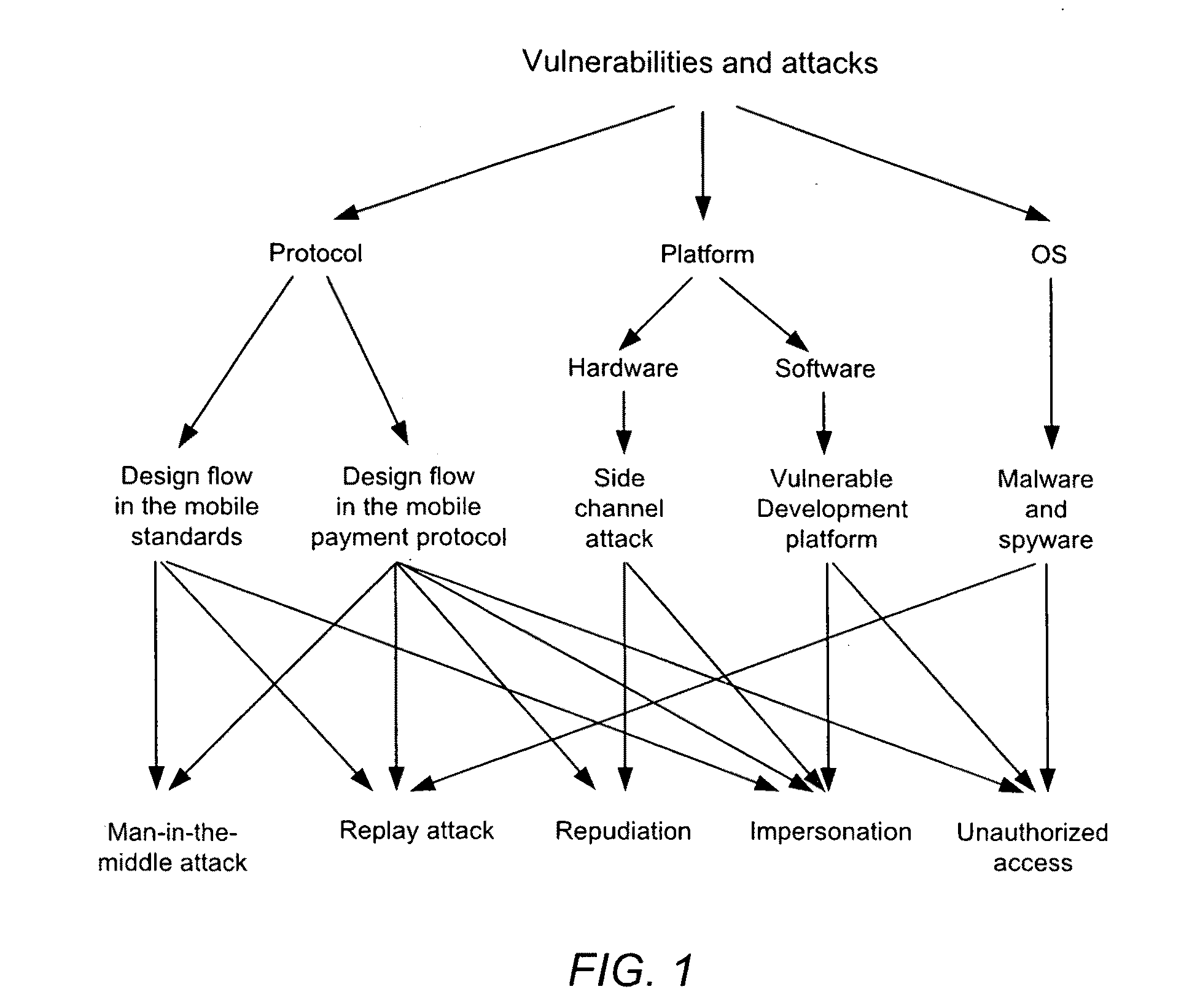

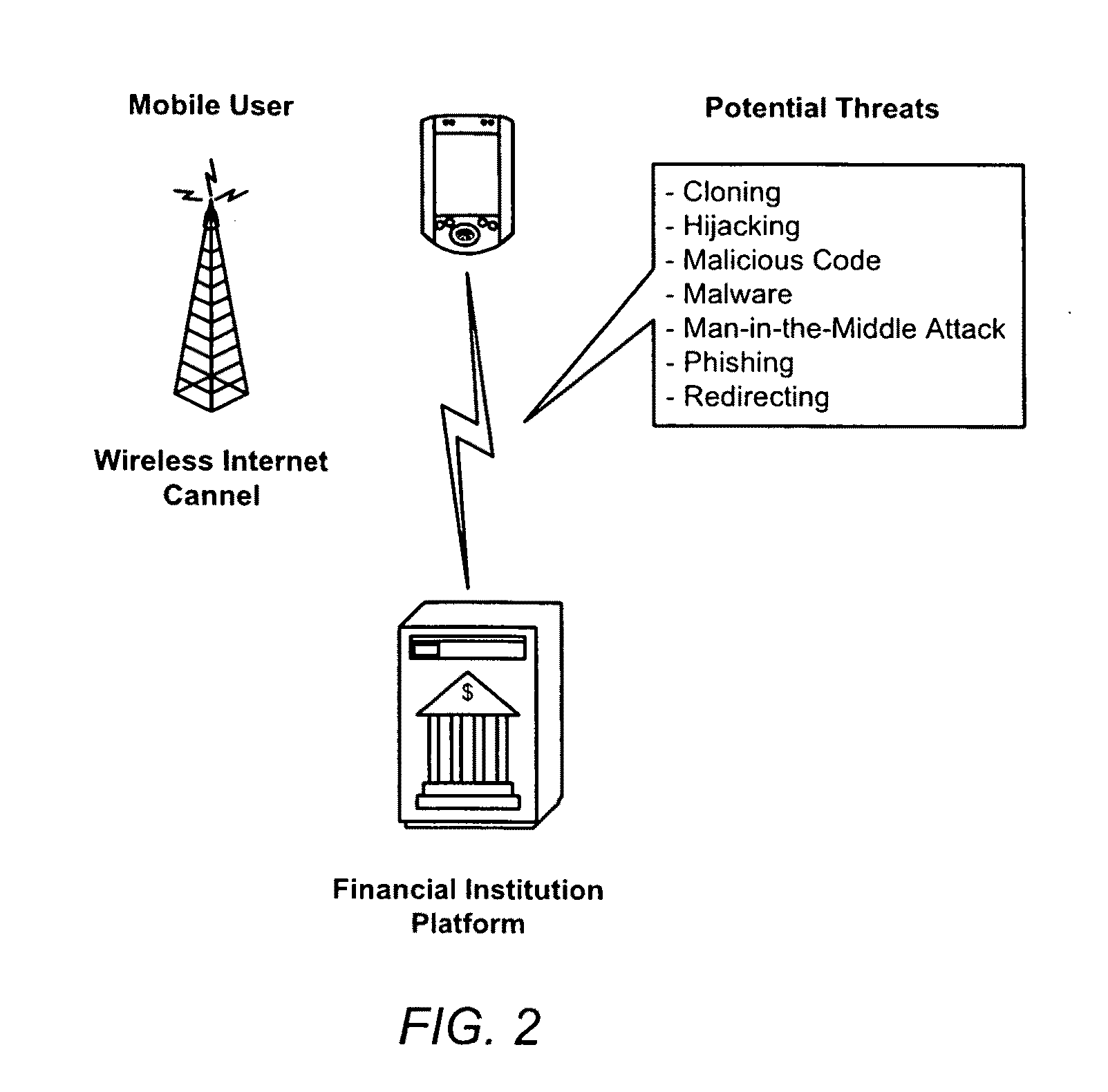

Mobile banking and payment platform

InactiveUS20100191602A1Fast transferProcess safetyFinanceUser identity/authority verificationPaymentComputer network

To eliminate, or at least substantially eliminate, the security concerns of conventional Internet-enabled mobile banking operations, and mobile banking operations in general, the present invention provides perhaps the most secure mobile banking and payment or product / service purchase method extent which avoids security problems of the Internet and provides a rapid transfer of transactional information and other information as desired, inclusive of revenue generating advertisements with the architecture and techniques of the present inventive Internet data protocol (DTP).

Owner:SKKY

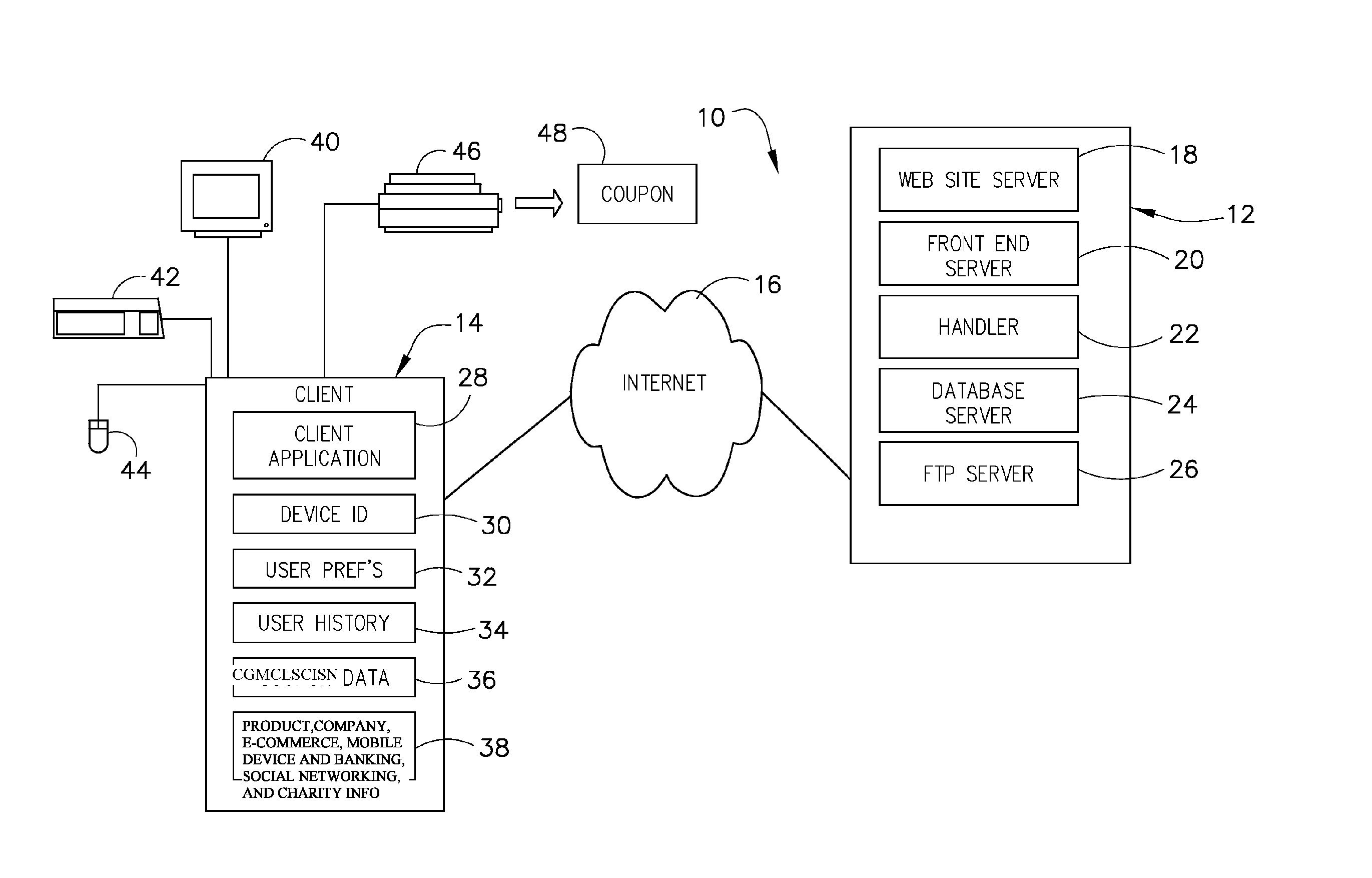

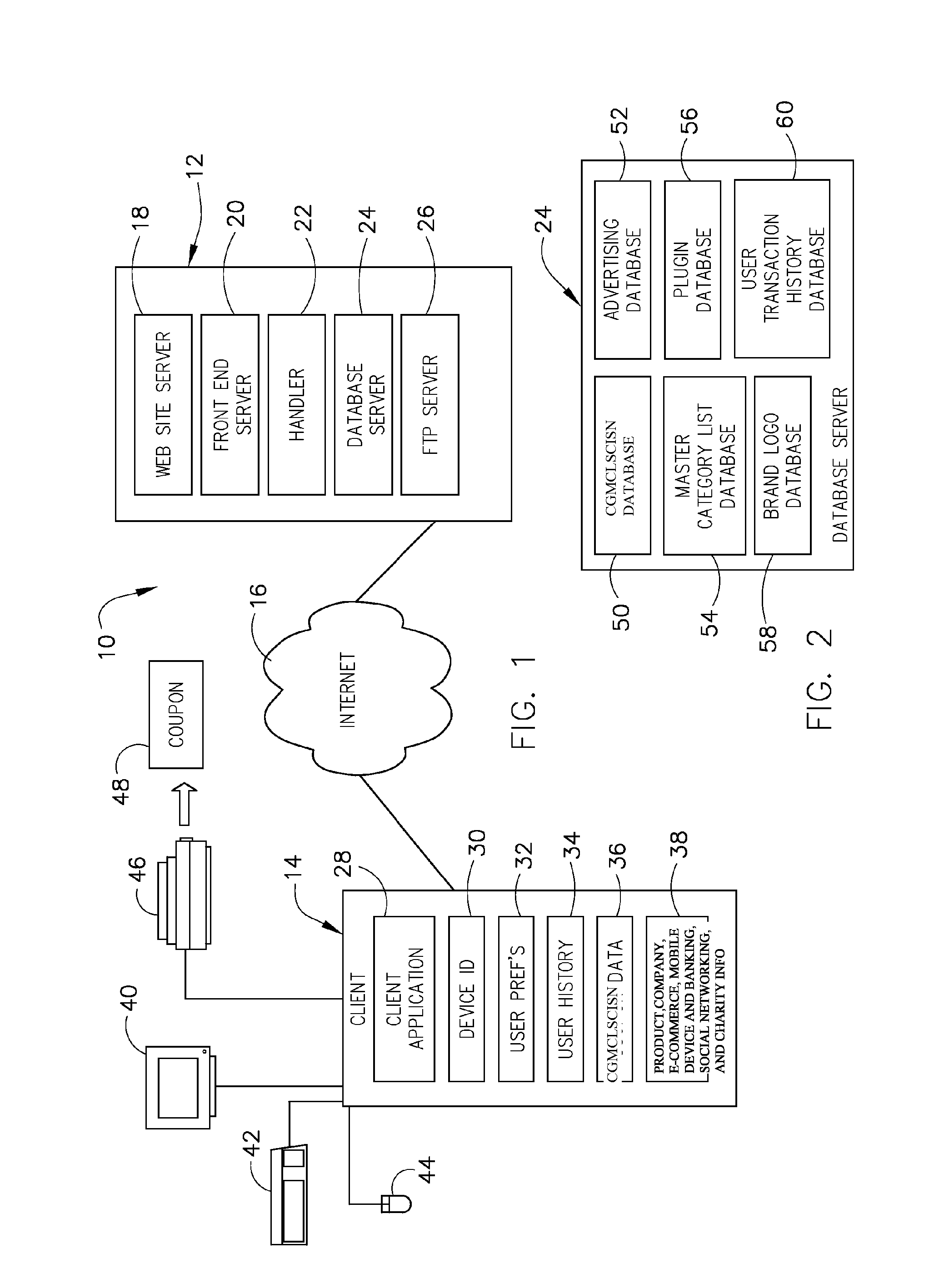

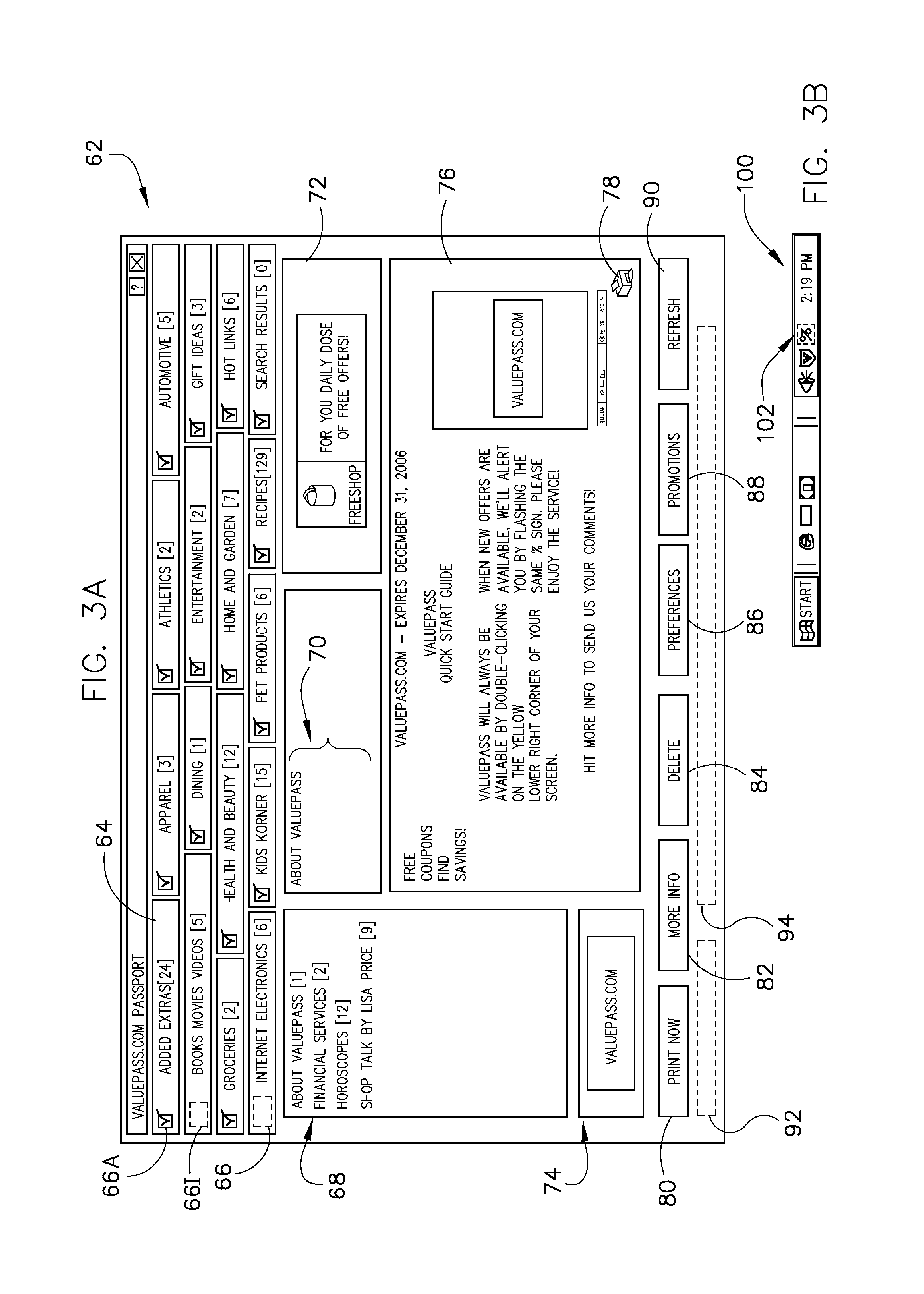

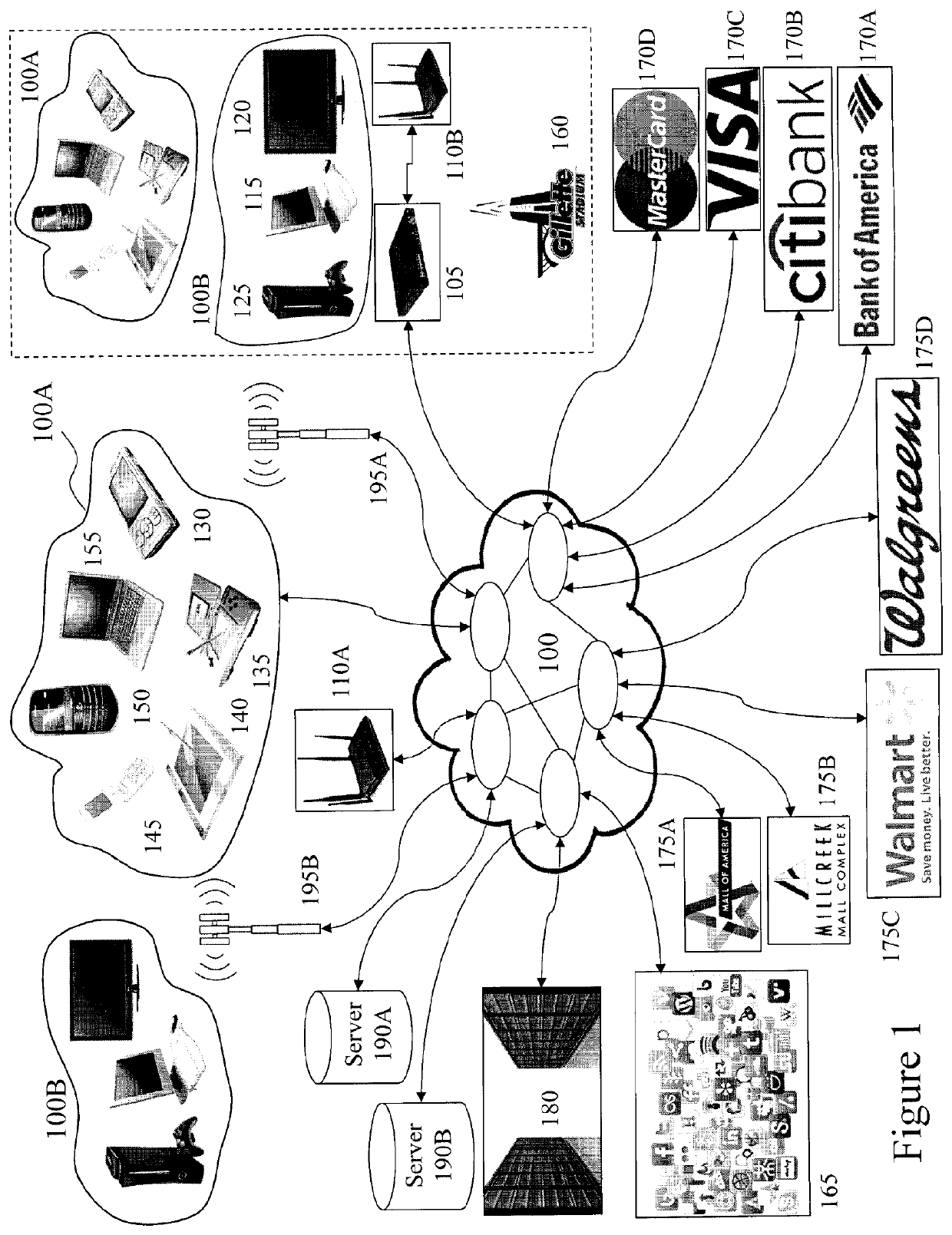

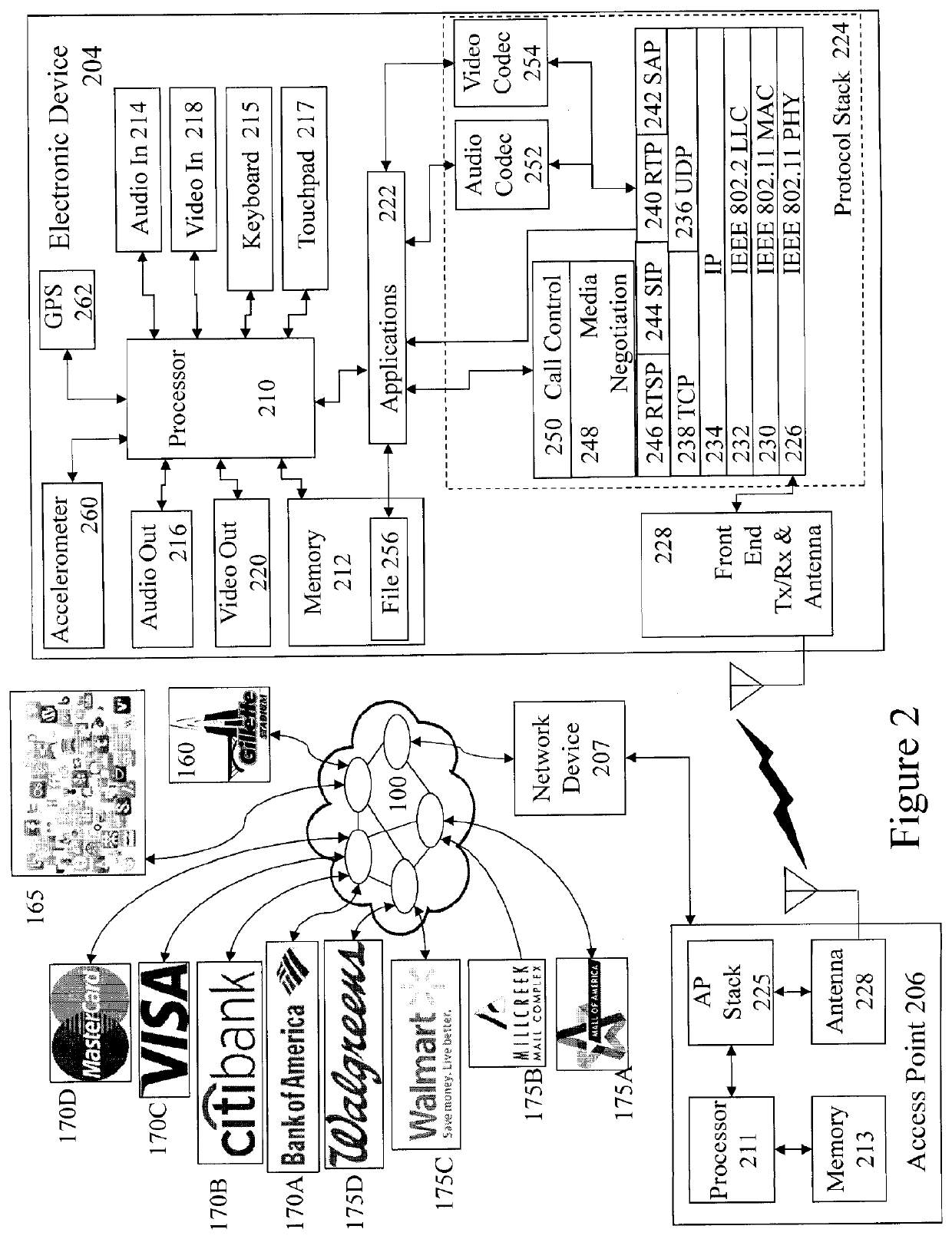

System and method for providing combined coupon/geospatial mapping/ company-local & socially conscious information and social networking (c-GM-c/l&SC/i-sn)

Alternative computer based systems and methods are provided for mobile device, mobile banking, server and / or cloud based internet access to a geospatial website for a multidimensional representation of information and / or scalable versions of web content that comprises social networking and / or socially conscious information and / or activities, digital coupons and discounts, and multi-dimensional and scalable geospatial mapping associated with entities providing and / or members of the coupons and / or social networking.

Owner:HEATH STEPHAN

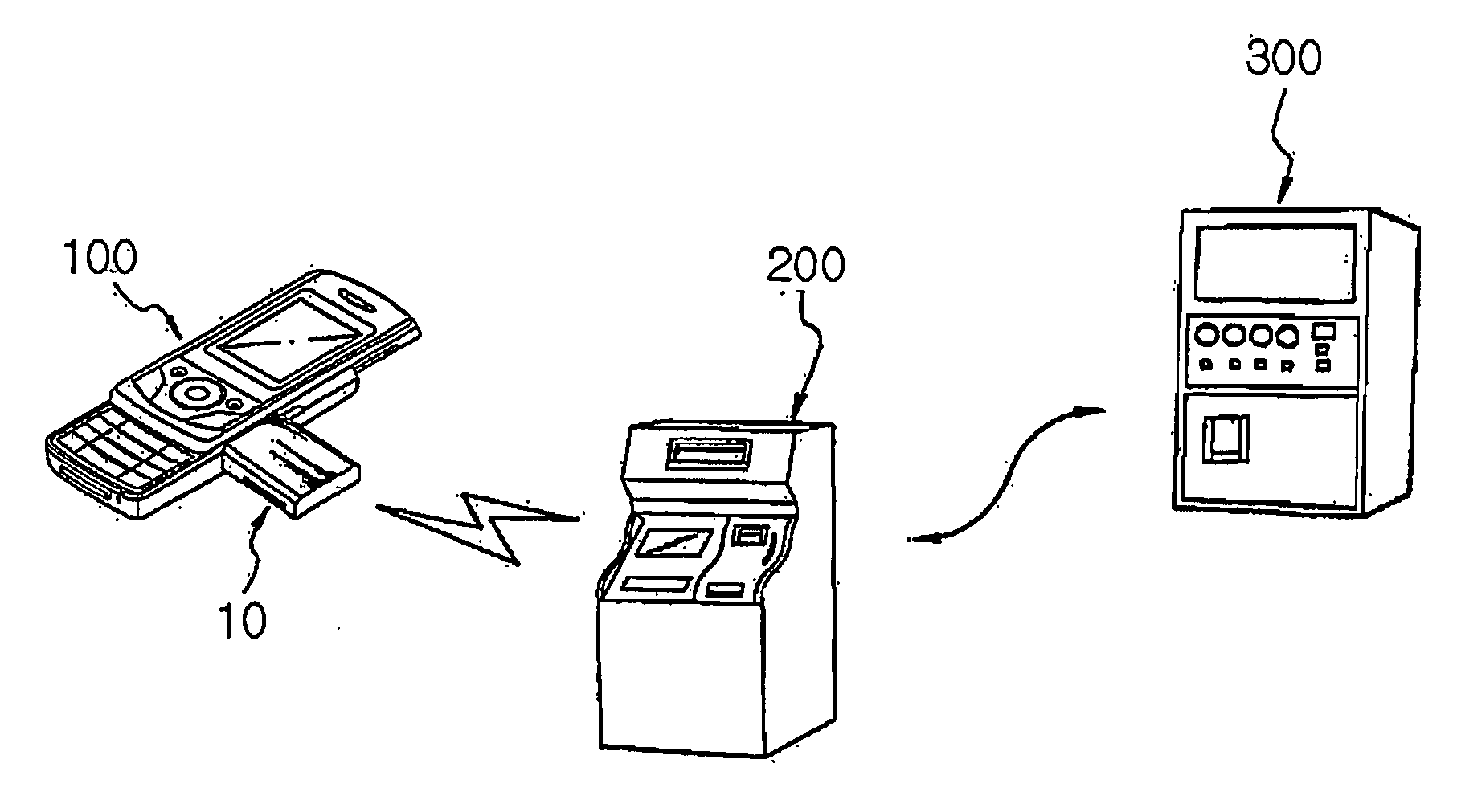

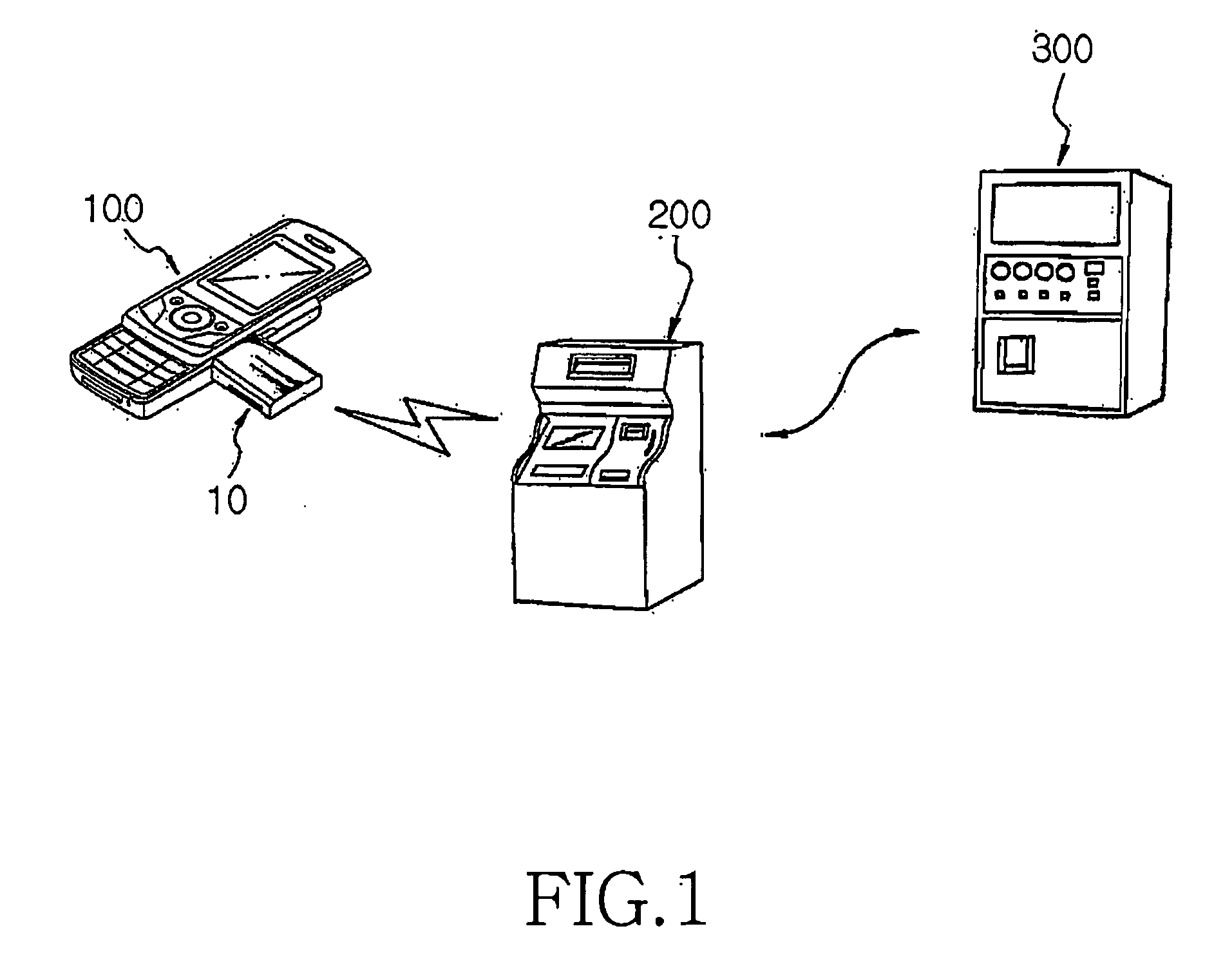

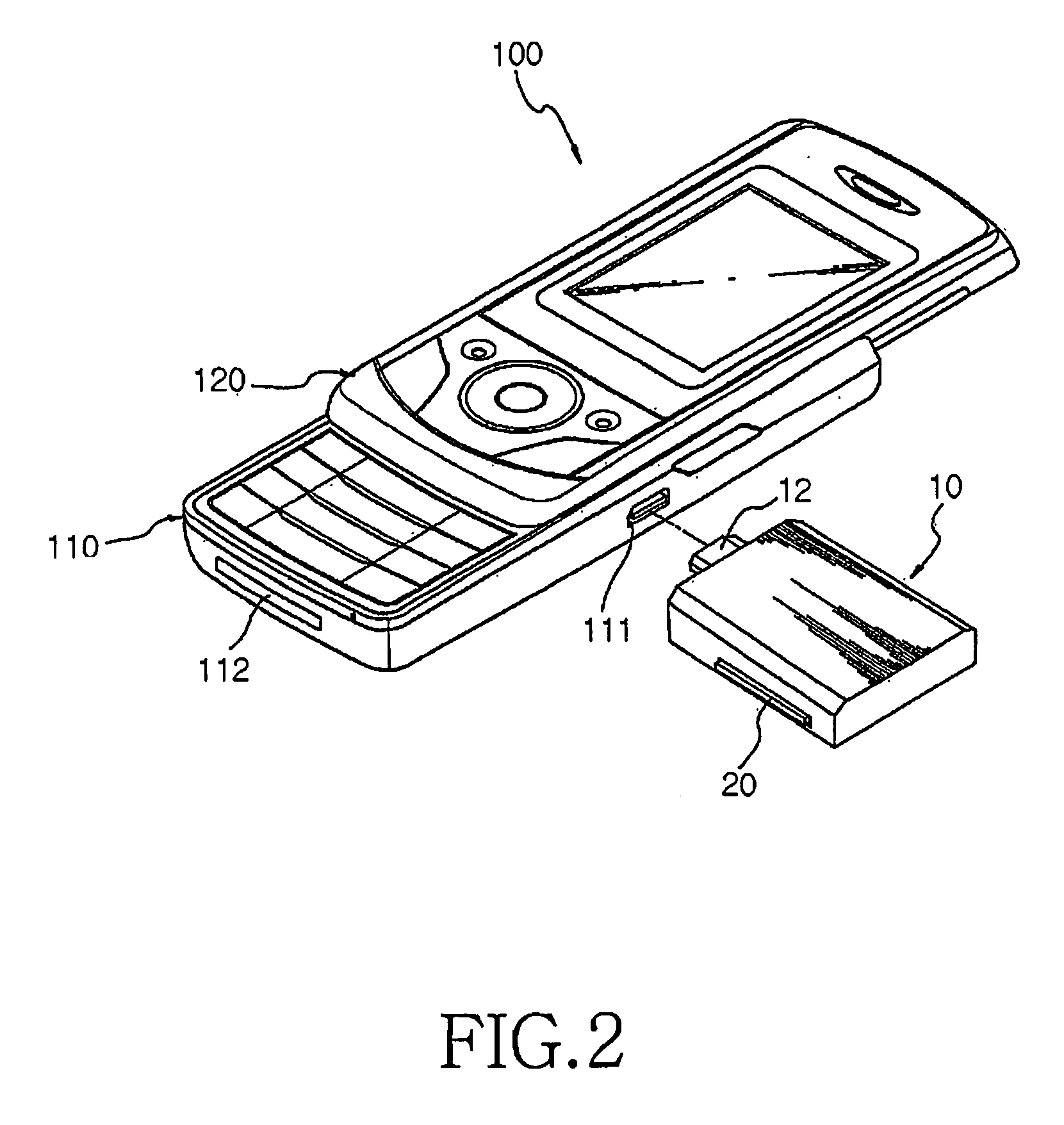

Multi-functional dongle for a portable terminal

InactiveUS20070235519A1Convenient banking transaction serviceGood serviceComplete banking machinesAcutation objectsTransaction serviceSound sources

Provided is a dongle that is connected to a portable terminal for providing a mobile banking transaction service with a banking equipment that includes a banking transaction unit for providing a mobile banking transaction service with a banking equipment; an FM transmitter for outputting a sound source played in a portable terminal through a speaker of an external FM receiver; a charger for receiving an external voltage to charge the portable terminal; and a connector to be connected to the portable terminal simultaneously or individually in order to perform functions of the banking transaction unit, the FM transmitter, and the charger. The banking transaction related components are implemented with a single separate device, i.e., dongle, and can be mounted when necessary. Therefore, a separate banking related module (software and / or hardware) is unnecessary, thereby slimming the portable terminal. In addition, the convenience of the banking transaction is improved because the dongle can be applied to general terminals having a minimum software specification.

Owner:SAMSUNG ELECTRONICS CO LTD

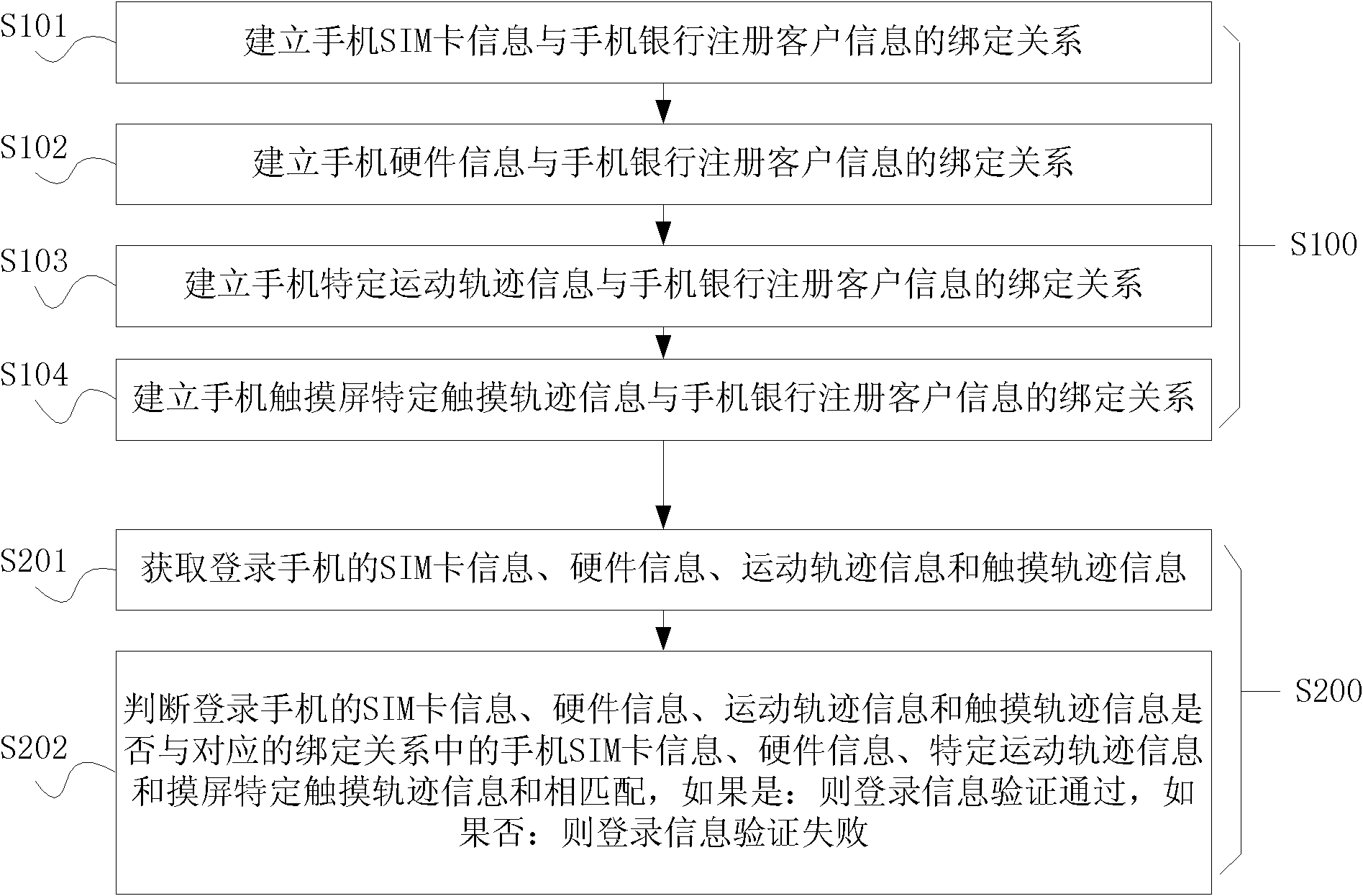

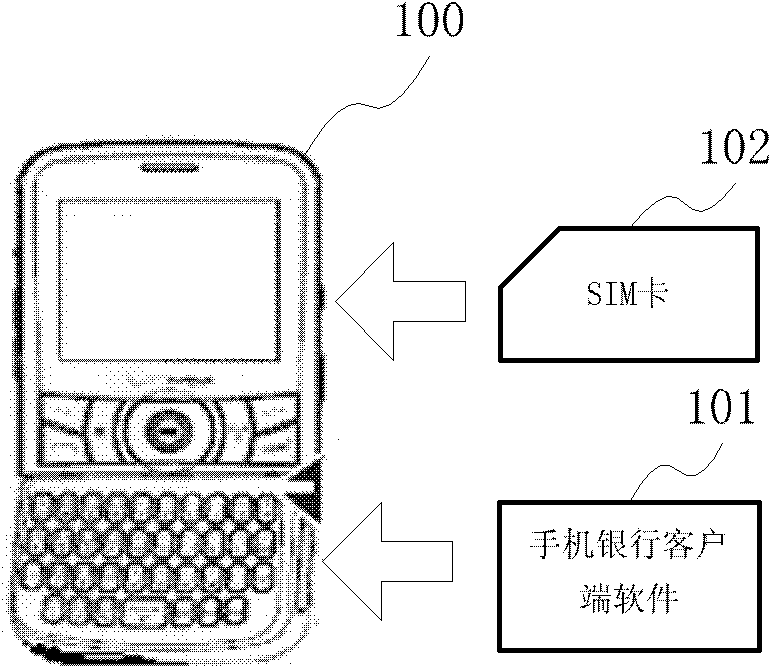

Method and system for authenticating mobile banking client information, and mobile terminal

ActiveCN102143482AImprove securityStrengthen security controlTransmissionSecurity arrangementCustomer informationClient-side

The embodiment of the invention provides a method and a system for authenticating mobile banking client information, and a mobile terminal. The method comprises a mobile banking customer information binding step and a mobile banking login information authenticating step, wherein the mobile banking customer information binding step comprises the following sub-steps of: establishing a binding relationship between mobile phone subscriber identity module (SIM) card information and mobile banking registered customer information, and establishing a binding relationship between mobile phone hardware information and the mobile banking registered customer information; and the mobile banking login information authenticating step comprises the following sub-steps of: acquiring the SIM card information and the hardware information of a login mobile phone, and judging whether the SIM card information and the hardware information of the login mobile phone are matched with the mobile phone SIM card information and the hardware information in the corresponding binding relationship, if so, passing the login information authentication, otherwise, failing to pass the login information authentication. The problem of security of mobile banking system information at the client is solved.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

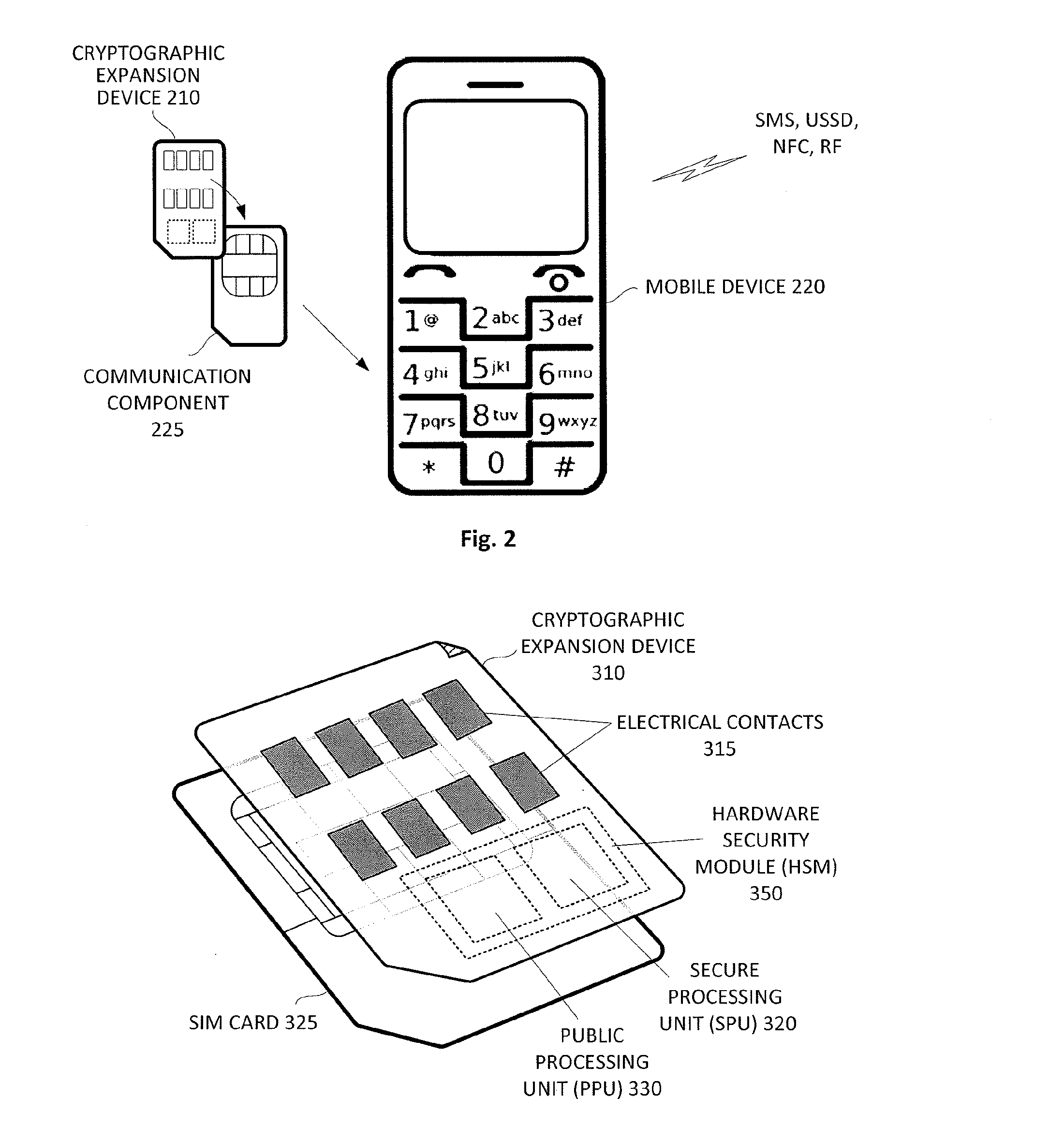

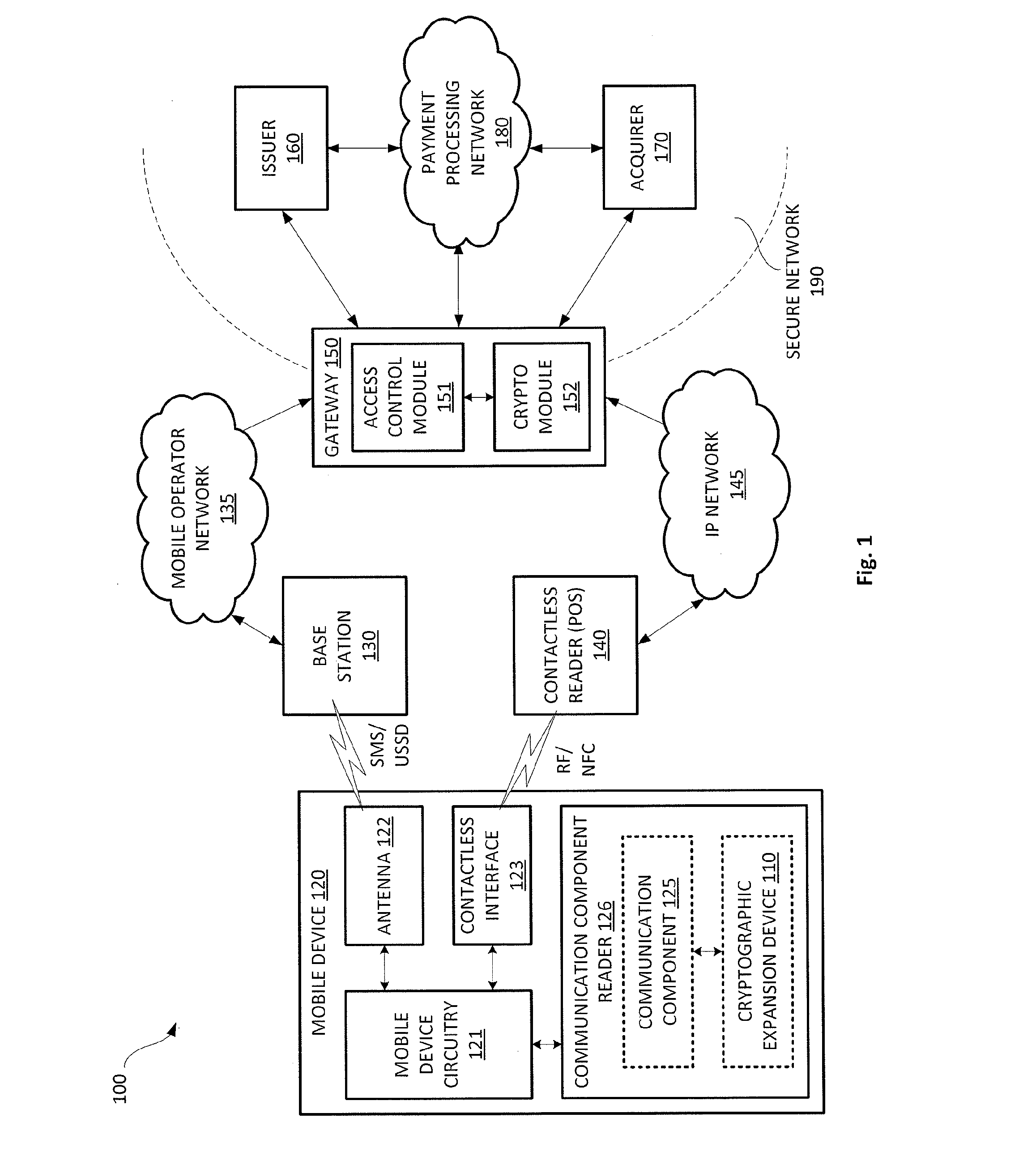

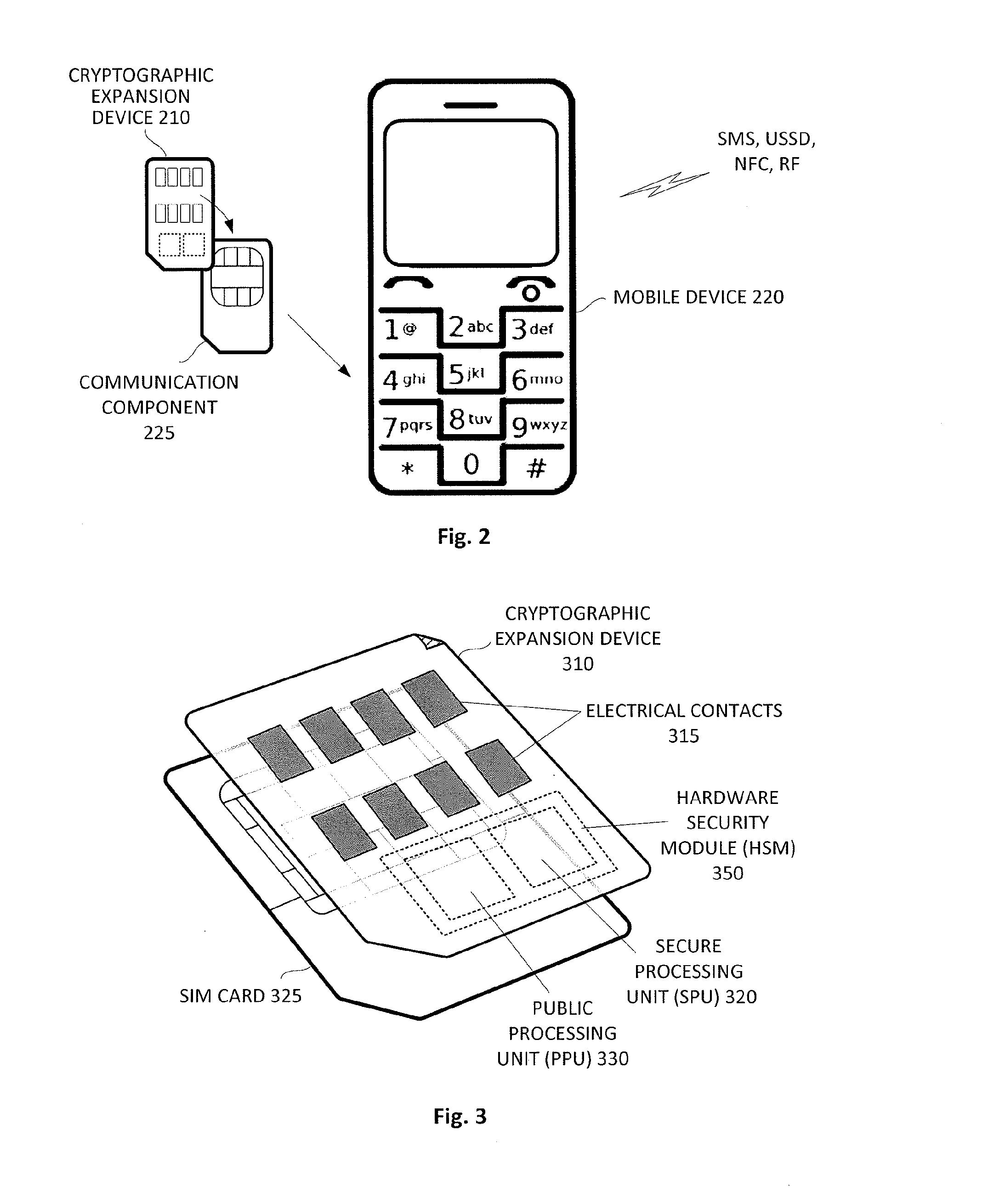

Mobile banking system with cryptographic expansion device

ActiveUS20140188738A1Prevent unauthorized accessPayment protocolsPrinted circuit manufactureSecure communicationComputer hardware

A mobile banking system that uses a cryptographic expansion device attached to a communication component of a mobile device and a secure gateway device to enable end-to-end secure communications between the mobile device and a payment processing network is disclosed. The cryptographic expansion device enables the mobile device to perform cryptographic operations on communications sent to and from the mobile device. The secure gateway device prevents unauthorized accesses to the payment processing network.

Owner:VISA INT SERVICE ASSOC

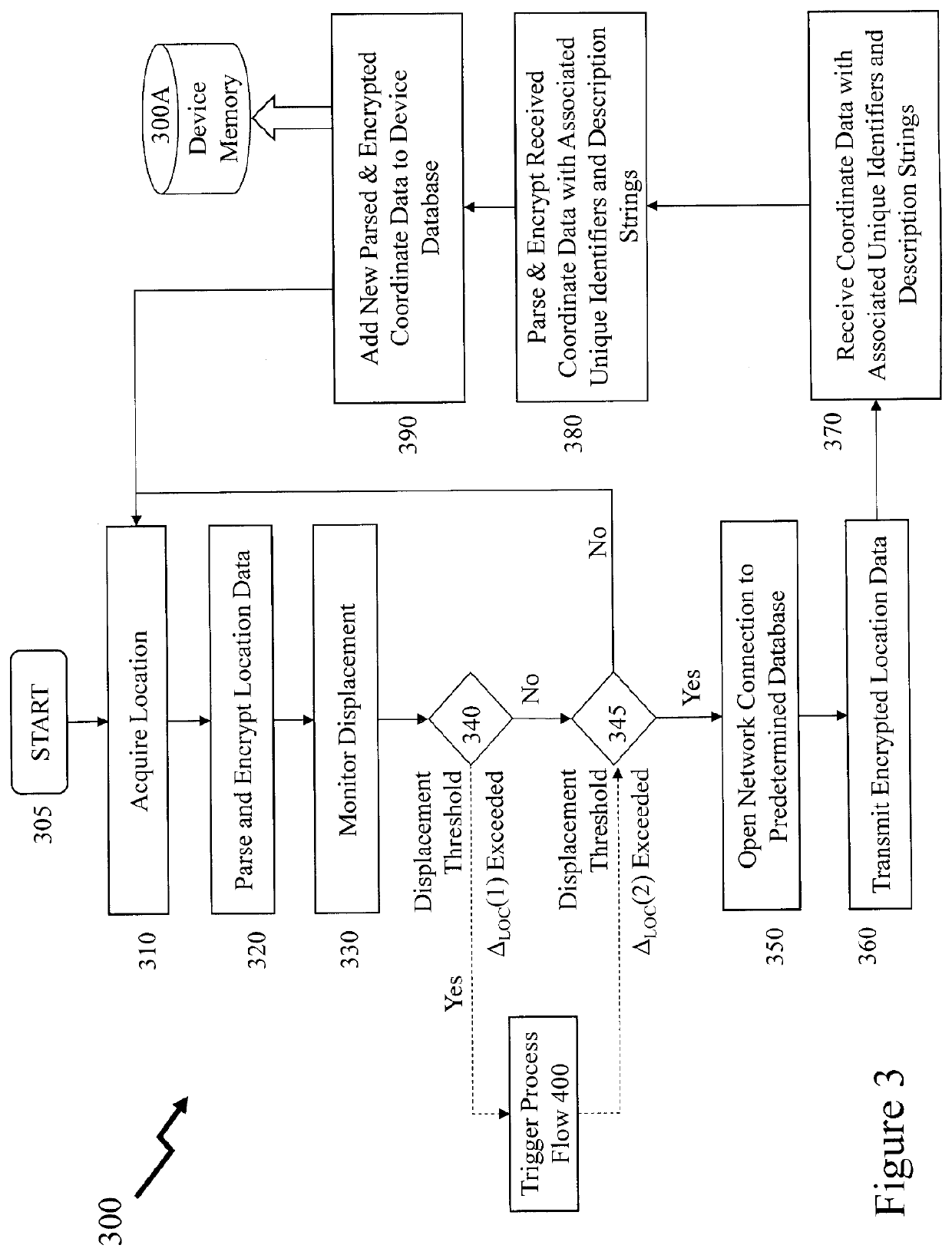

Secure location based electronic financial transaction methods and systems

Mobile payments to Point-of-Sale (PoS) terminals, kiosks, vending systems etc. as well as mobile banking are increasingly common due to the electronic devices available. However, fraud is an ongoing issue. Embodiments of the invention support increased security by applying processes which allow for easy and secure development of financial transaction services and equipment. Accordingly, the location of the consumer performing the financial transaction is included within the process. Embodiments include a consumer being physically present to authorise irrespective of authorisation of their credentials, a consumer may establish preferred locations for transactions, a retailer and consumer may perform the transaction once the consumer has left the retail location through stored location data of the user's device. Embodiments of the invention also support financial transactions without a direct PoS transaction as the user's device and the PoS terminal broker the transaction in the cloud using location data.

Owner:MURPHY JEAN LOUIS

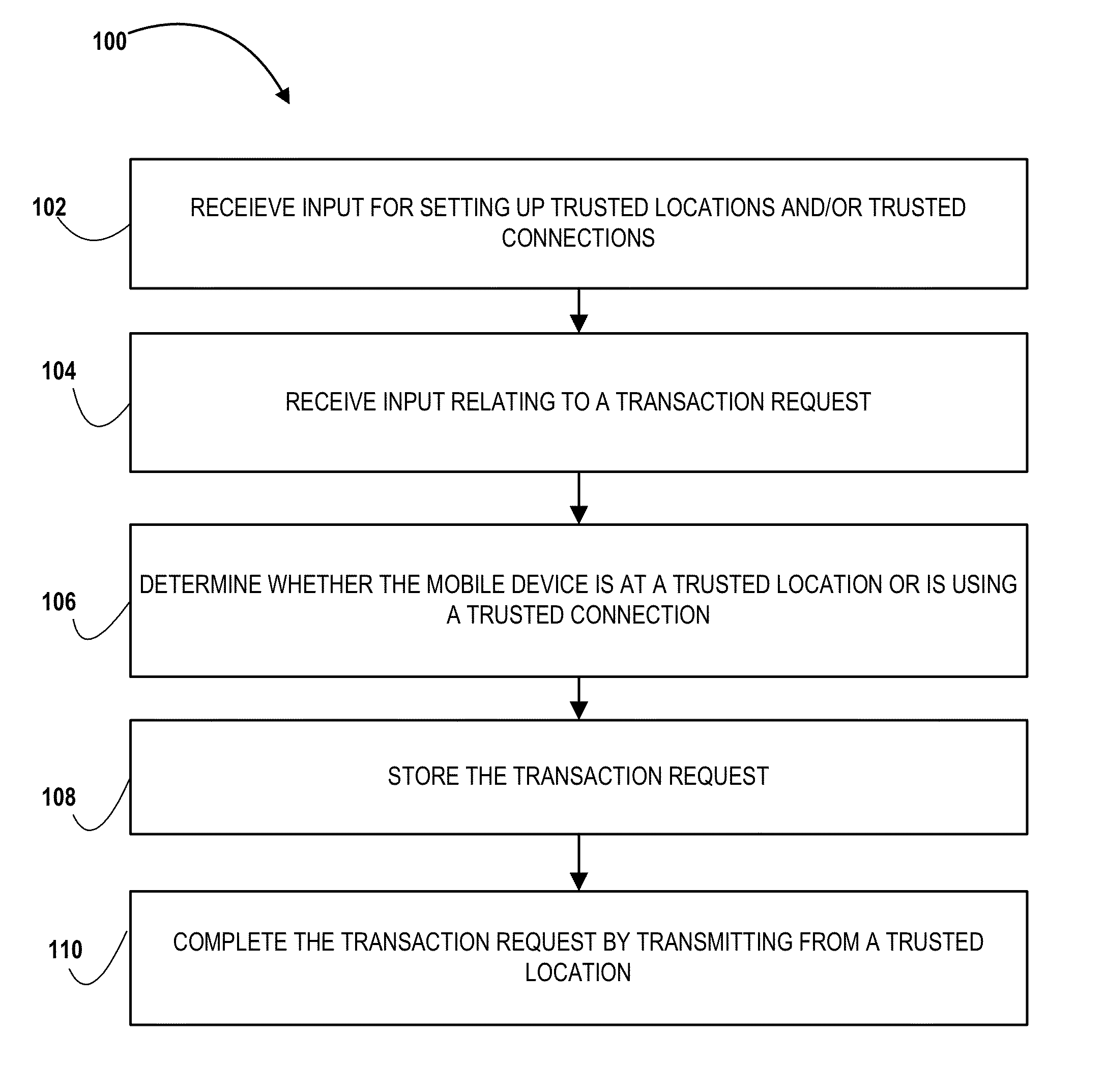

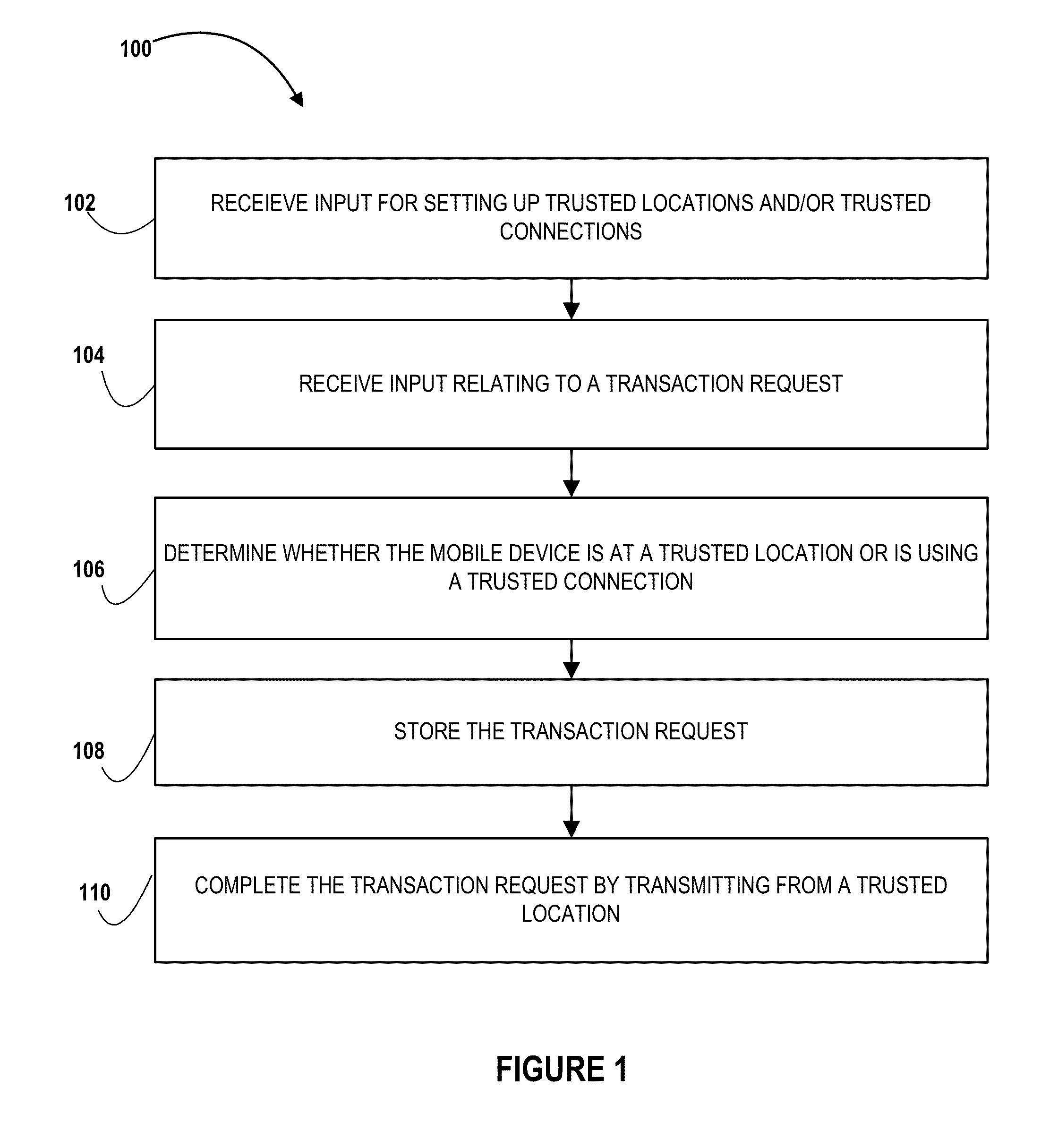

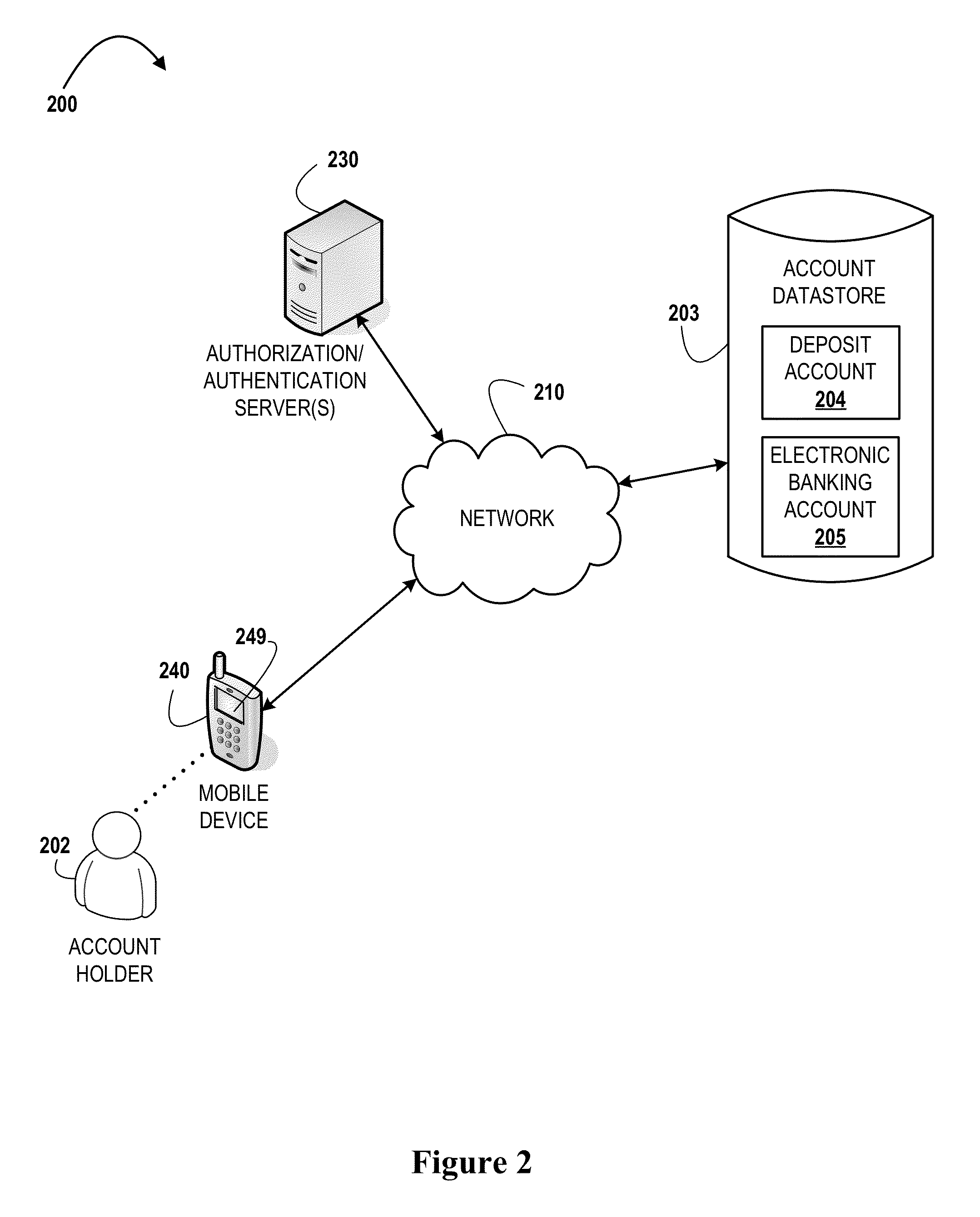

Completing mobile banking transaction with different devices

Embodiments of the present invention relates to systems, computer-implemented methods, and computer program products for completing a mobile banking transaction at a trusted location. In some embodiments, the system is configured to: (a) initiate, via a mobile device, a transaction request for a mobile banking transaction; (b) store the transaction request for the mobile banking transaction in a queue for mobile banking transaction requests; (c) retrieve from the queue, using a computing device, the transaction request for the mobile banking transaction, wherein the computing device is different from the mobile device; and (d) complete, using the computing device, the transaction request for the mobile banking transaction.

Owner:BANK OF AMERICA CORP

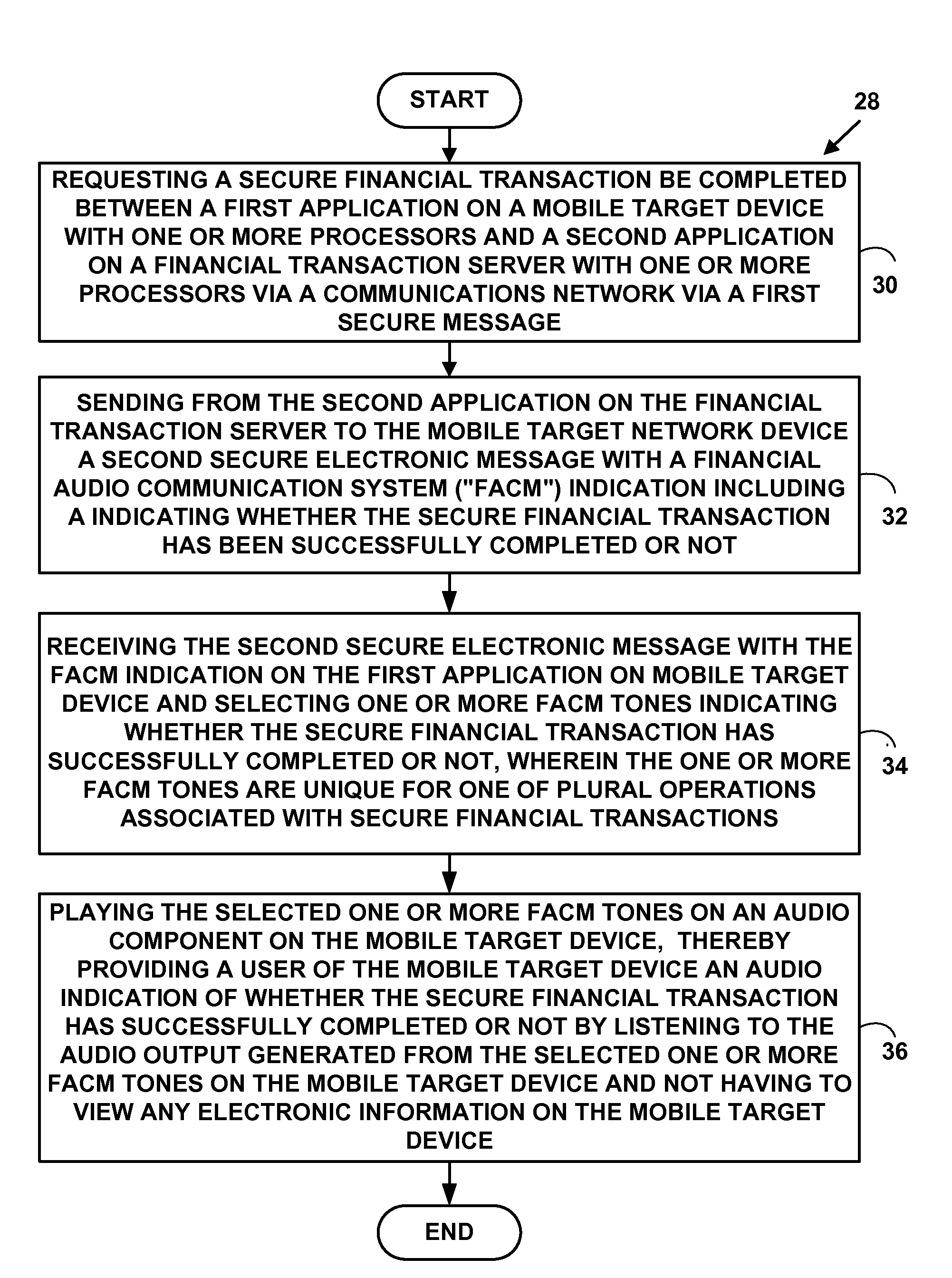

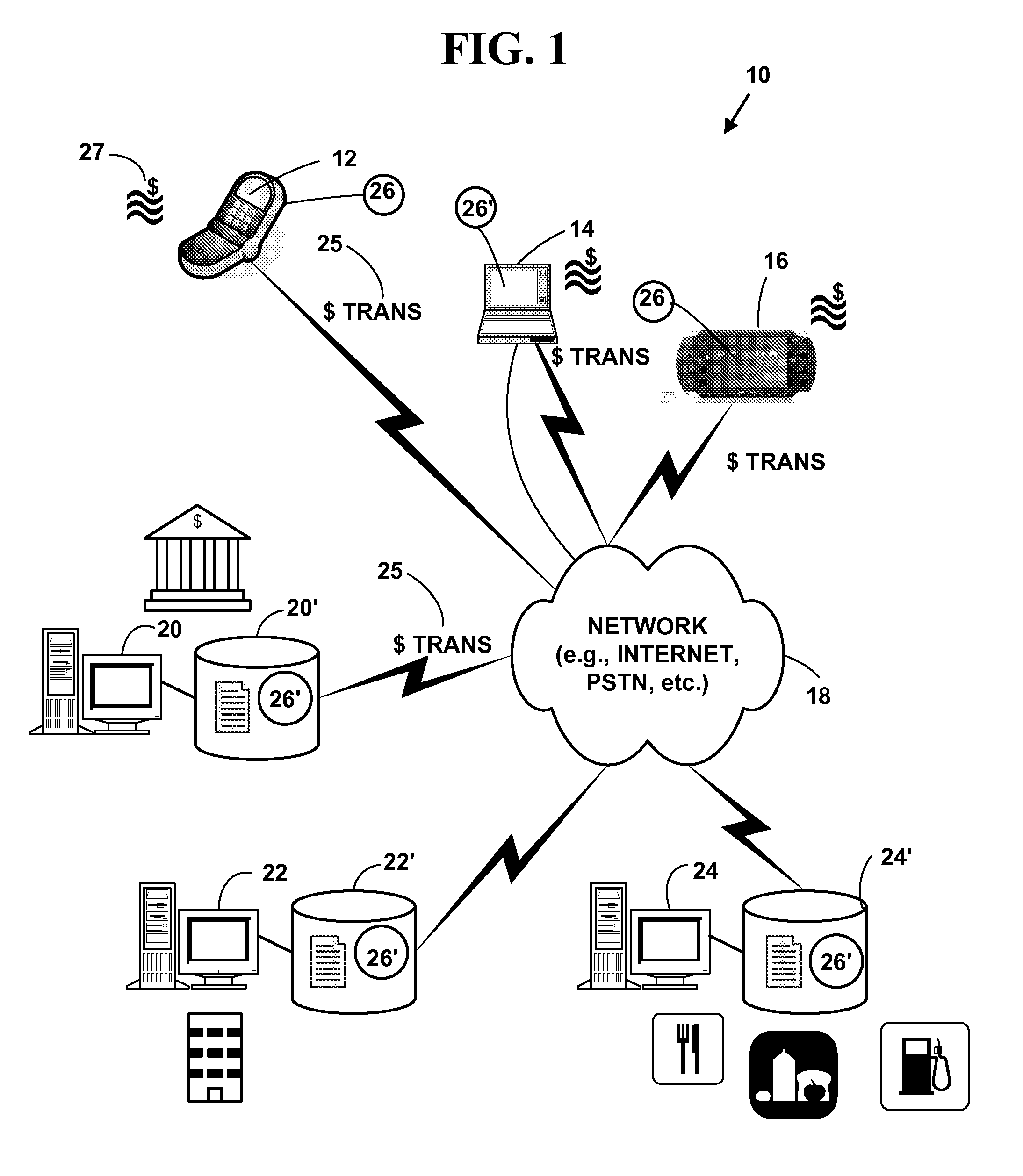

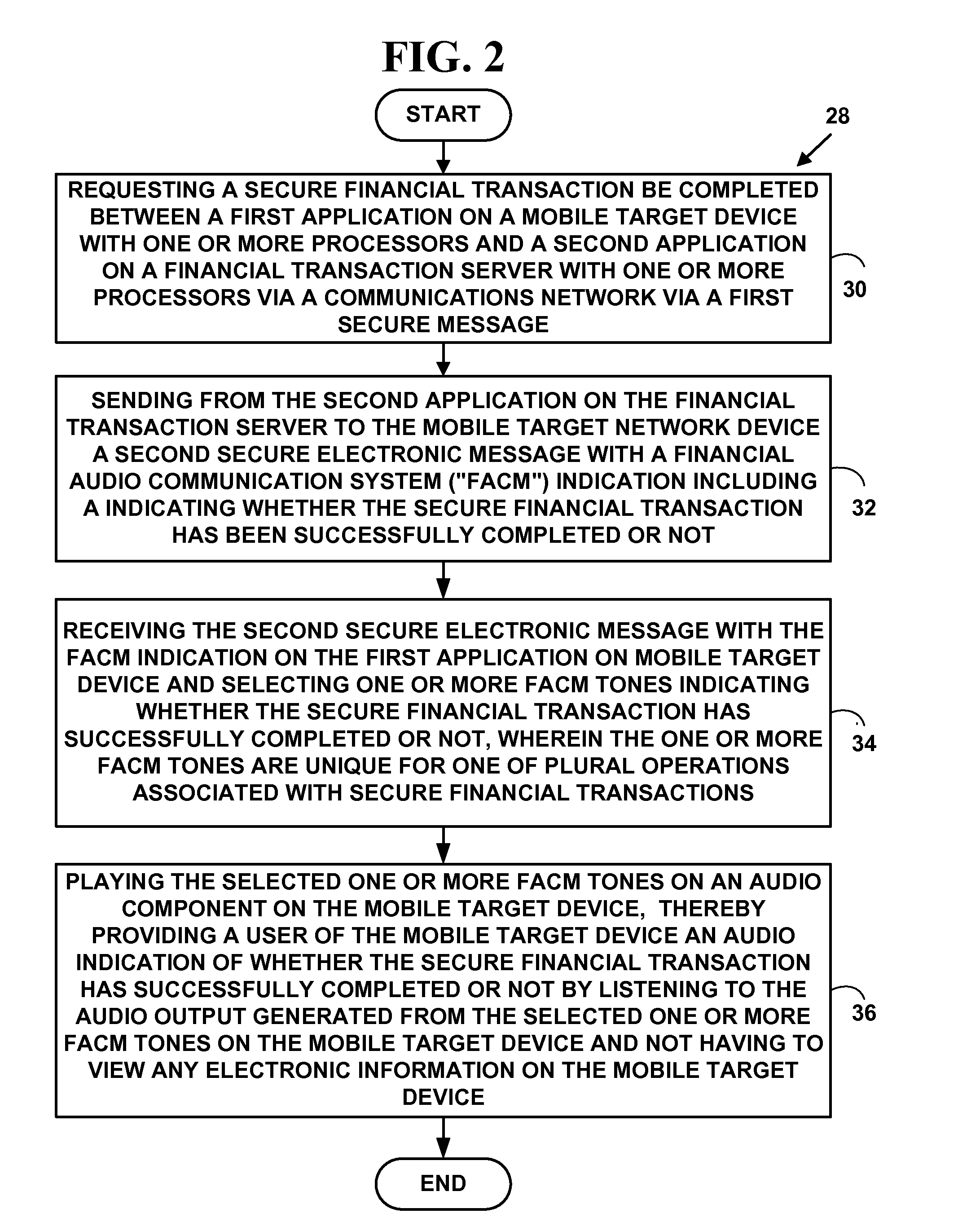

Method and system for mobile banking and mobile payments

A method and system for mobile banking and mobile payments is presented. A mobile device attempting a financial transactions receives an indication that the financial transaction has or has not been successfully completed via an electronic message and a unique “Financial Audio Communication System” (“FACM”) indication. A user of the mobile target device can determine whether the financial transaction has successfully completed or not by listening to the audio output generated from the FACM indication on the mobile target device and does not have to view textual information on the mobile target device.

Owner:HEATH STEPHAN

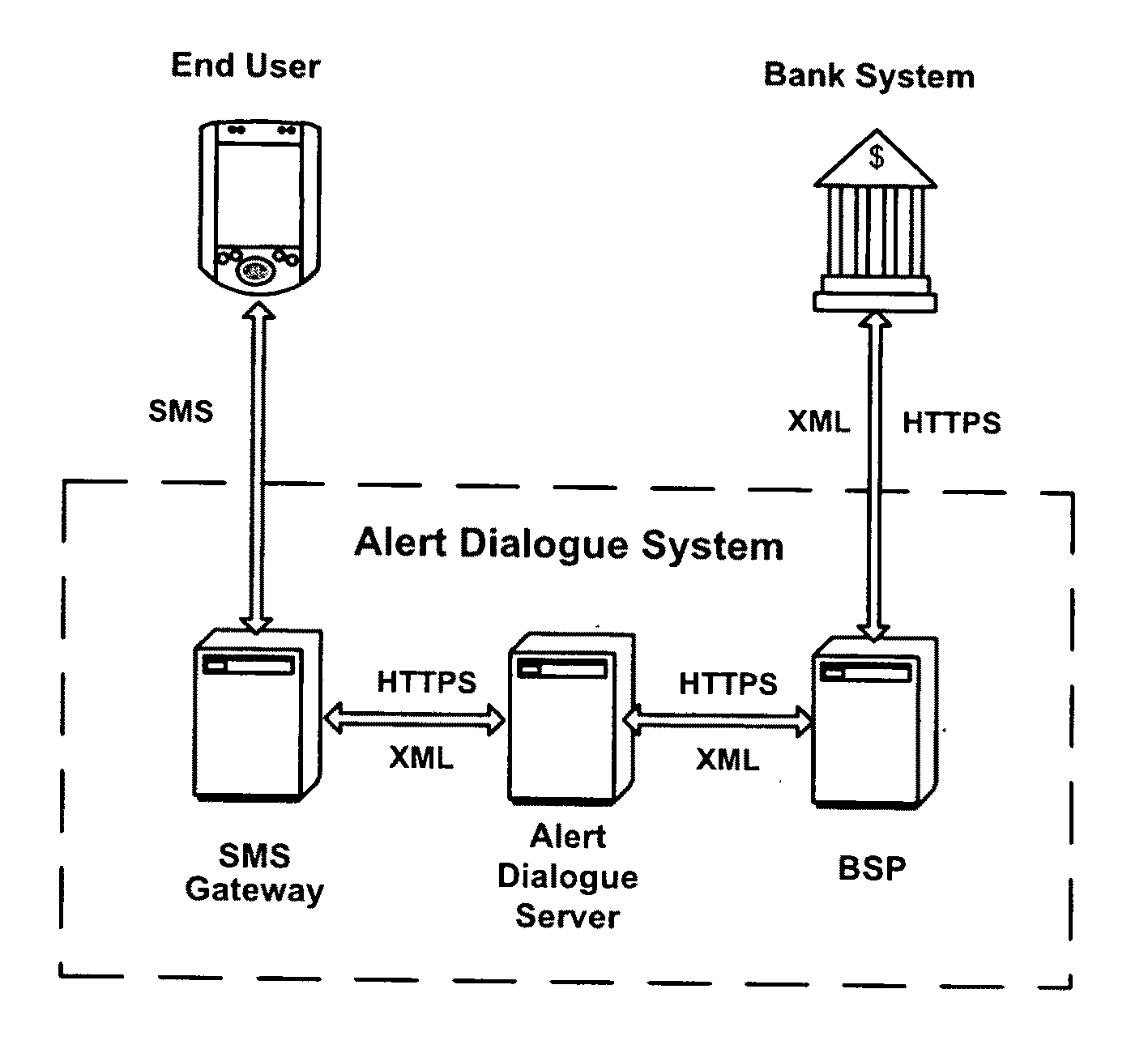

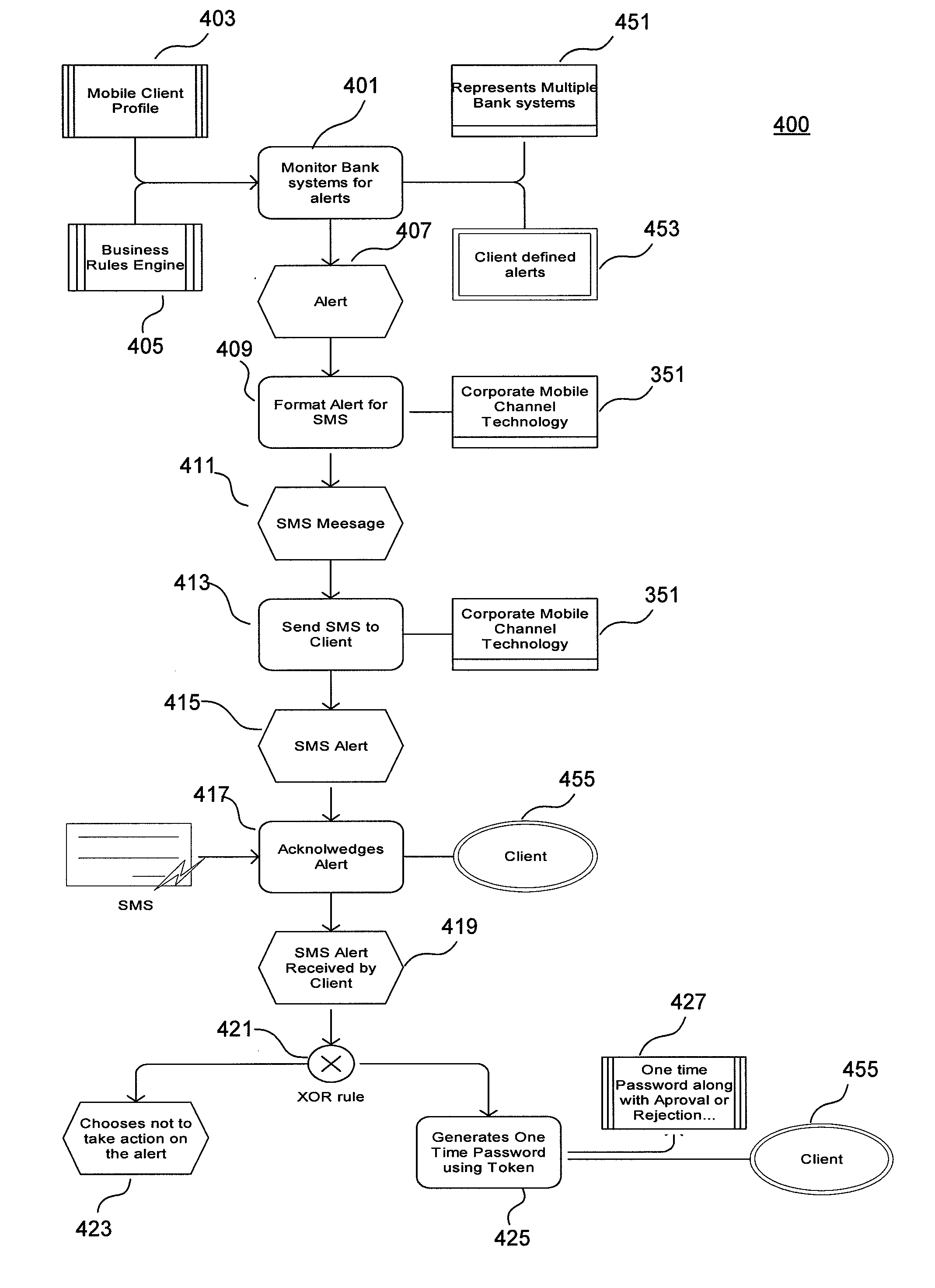

Actionable Alerts in Corporate Mobile Banking

Techniques for alerting a client about a pending payment over a communication device by a financial institution are disclosed. The client is able to view the alert on a communication device and can reply to the alert with an answer on how to process the pending payment. A designated user can consequently respond to issues without having to call staff or to log into the business's computer system. The response sent through the communication device indicates the designated user's decision to the financial institution's payment system. The payment service determines whether an alerting message should be sent to a designated user based on at least one criterion based on a set of business rules. The designated user is authorized to approve or reject the pending payment. In response to the alerting message, the designated user returns a response that contains payment information and a one-time password.

Owner:BANK OF AMERICA CORP

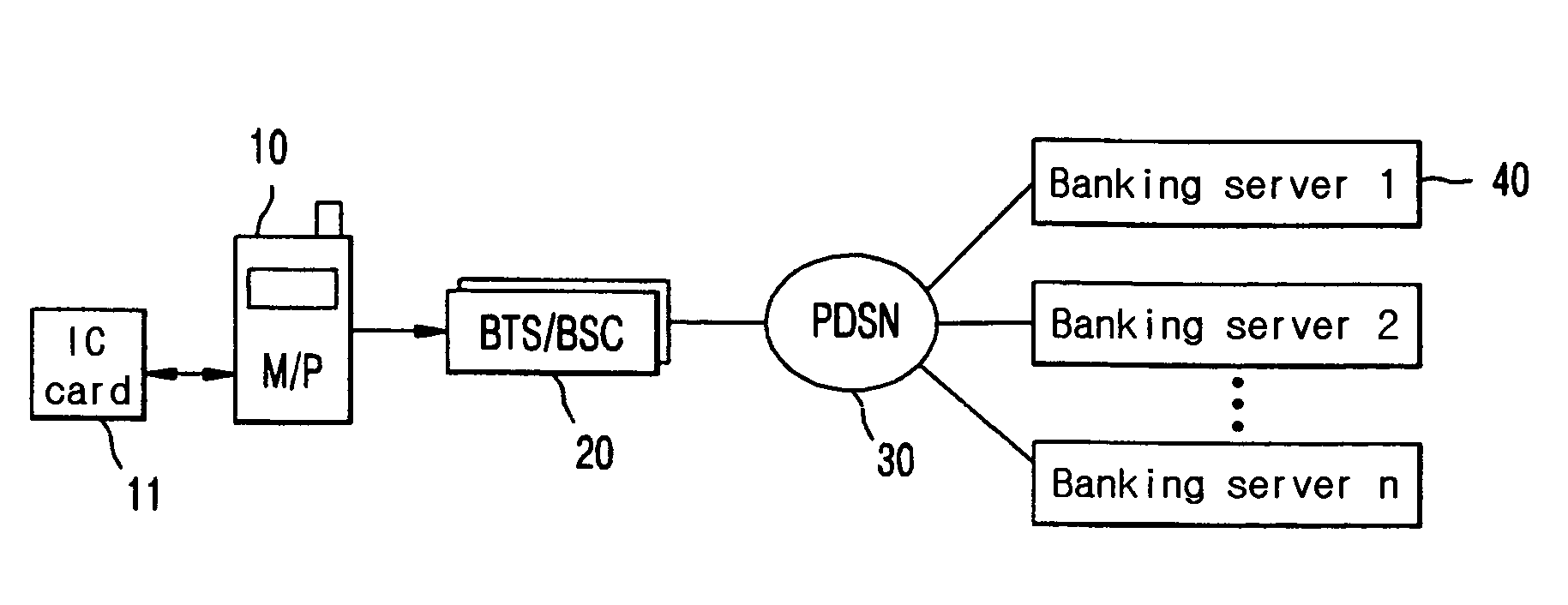

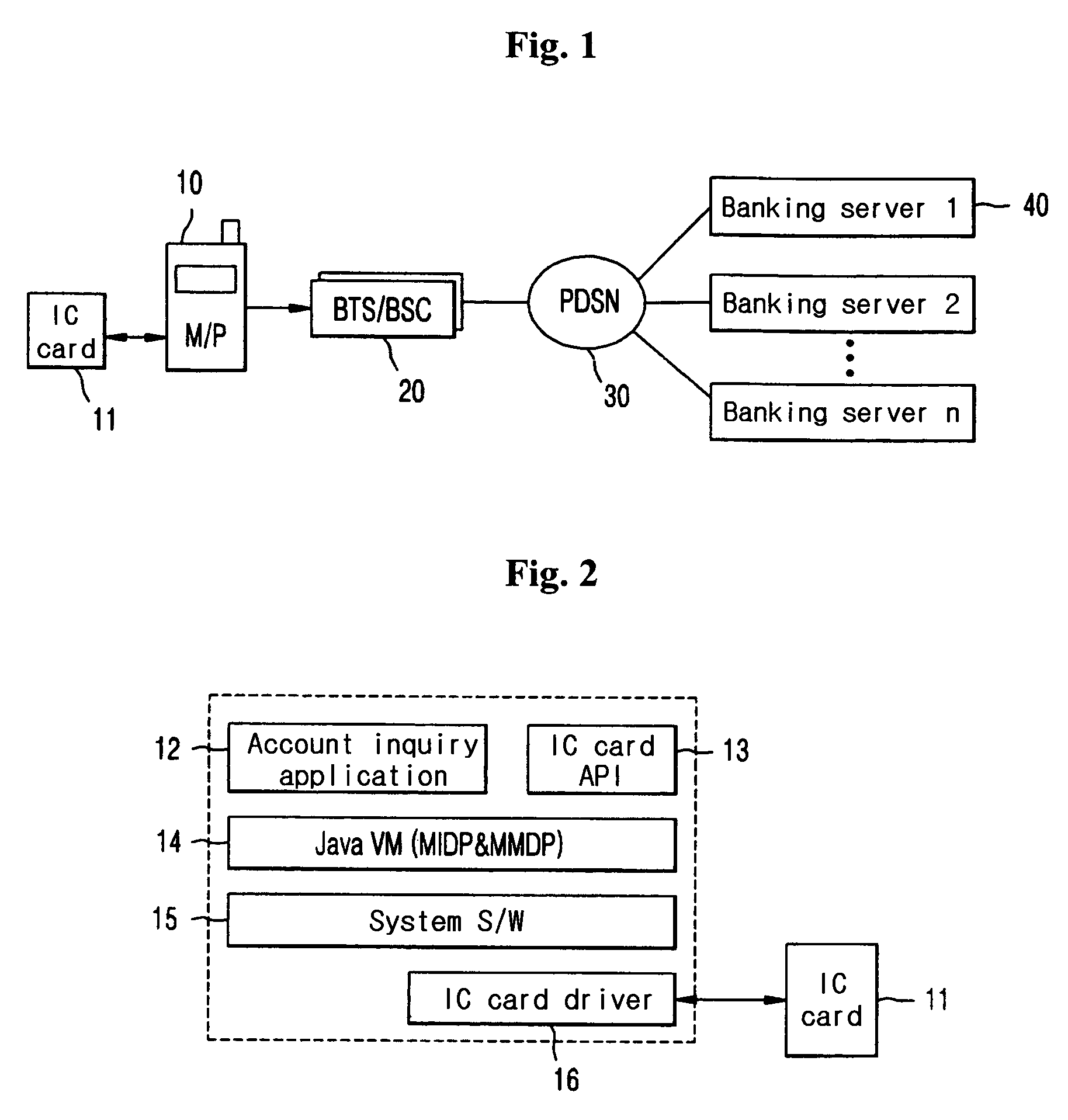

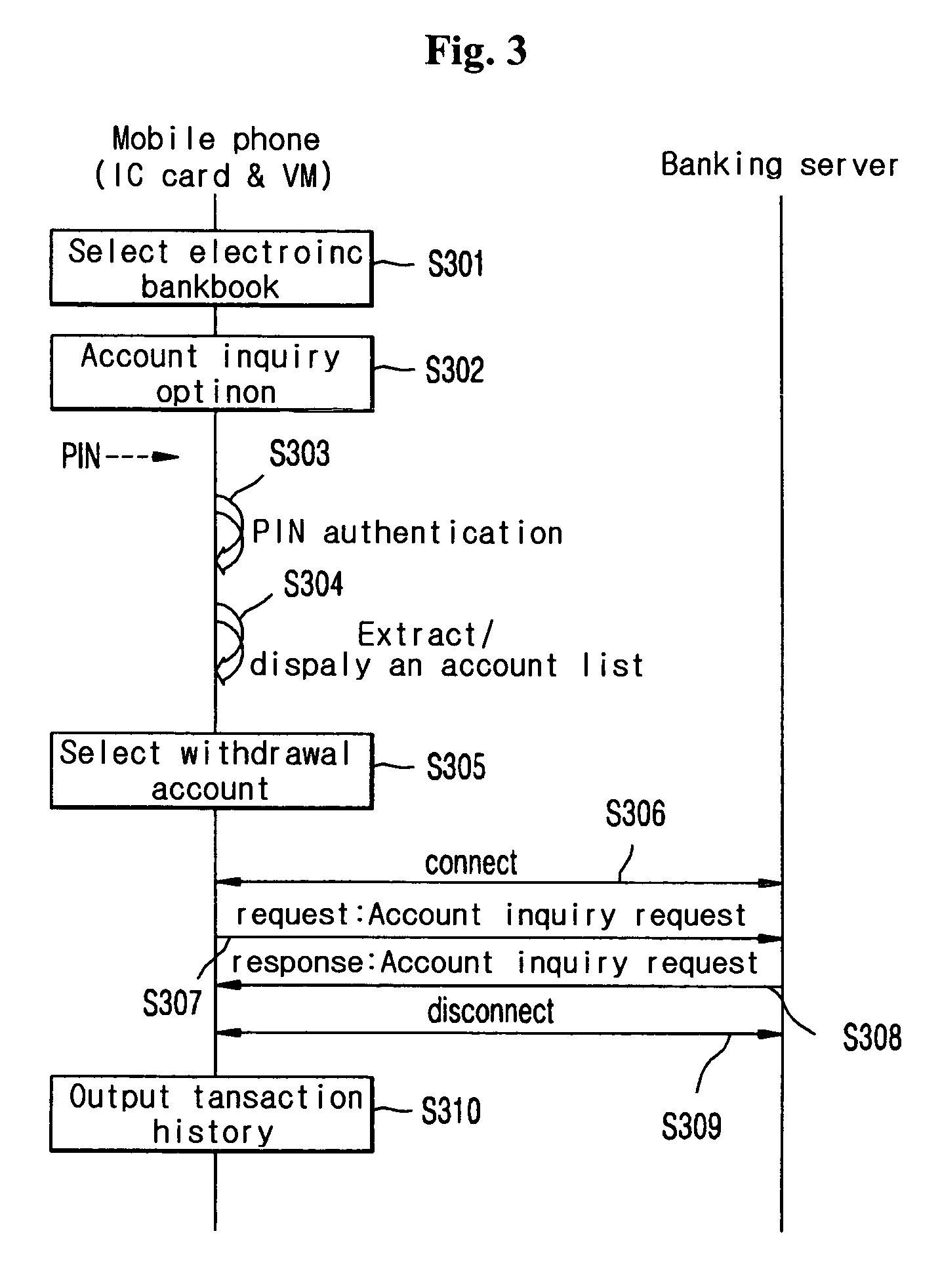

System for providing banking services by use of mobile communication

InactiveUS7885870B2Simple inputShorten access timeFinanceNetwork traffic/resource managementTransceiverFinancial transaction

A system for providing banking services by use of a mobile communication system, in which a variety of financial transactions including inquiry of at least one financial account of at least one financial institution, transfer and remittance, and loan and its interest payment are processed by the mobile communication system. The system includes: the mobile communication system, provided with an integrated circuit (IC) card and a memory device to which a banking application is installed, for transmitting and receiving data by wireless, the IC card being stored with information on a personal identification number (PIN) and information related to financial accounts including a loan account. The banking application processing the financial transactions including the financial account inquiry, the transfer and remittance, and the loan and its interest payment by mobile banking; a base station transceiver system (BTS) for executing a wireless interface with the mobile communication system and a base station controller (BSC) for performing call processing and for providing a core network interface with the BTS. A packet data switching network (PDSN) for providing a packet data transfer service using a transmission control protocol / Internet protocol (TCP / IP); and at least one banking server for, when being requested to process the financial transactions including the financial transactions including the financial account inquiry, the transfer and remittance, and the loan and its interest payment by the banking application of the mobile communication system.

Owner:LG UPLUS

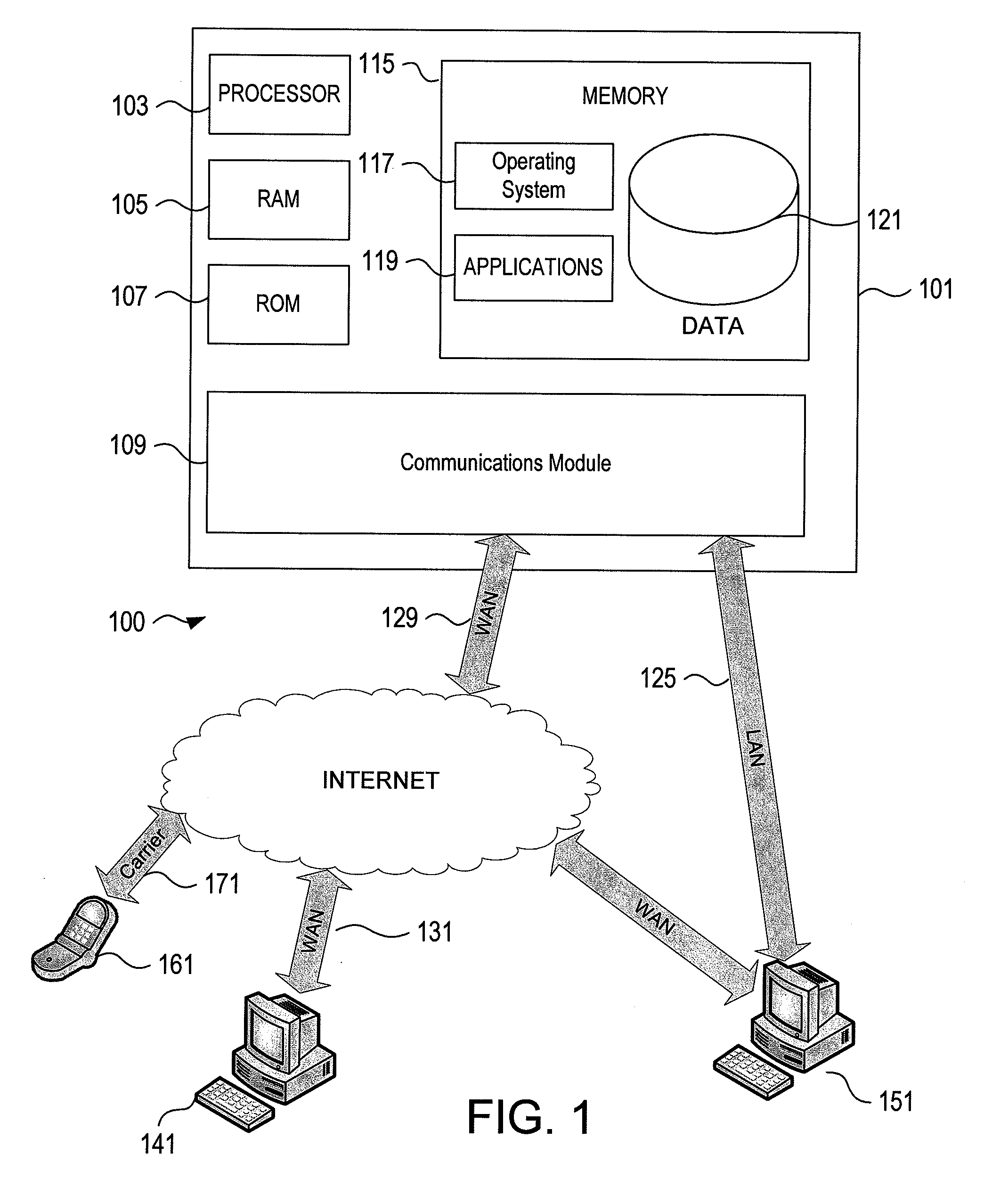

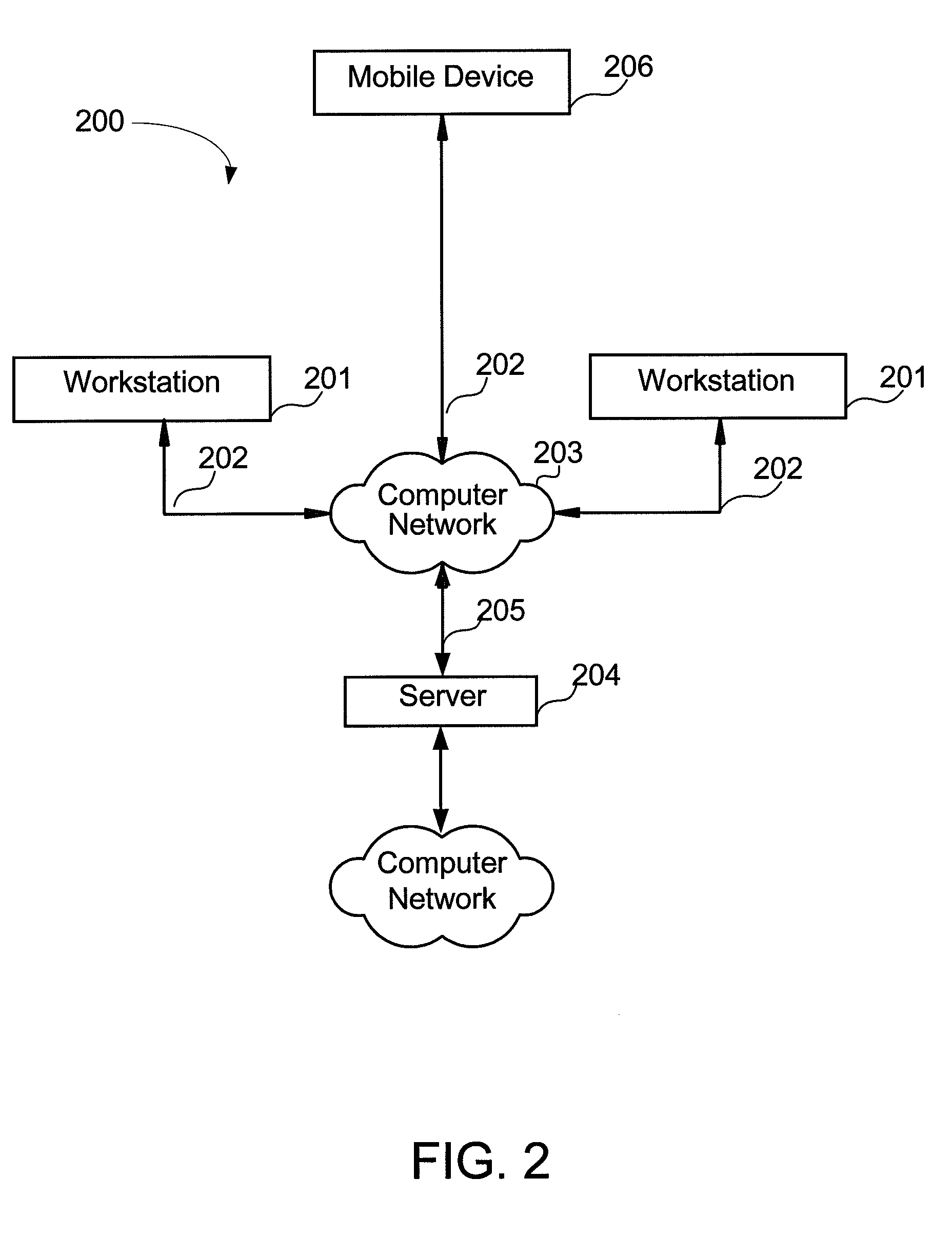

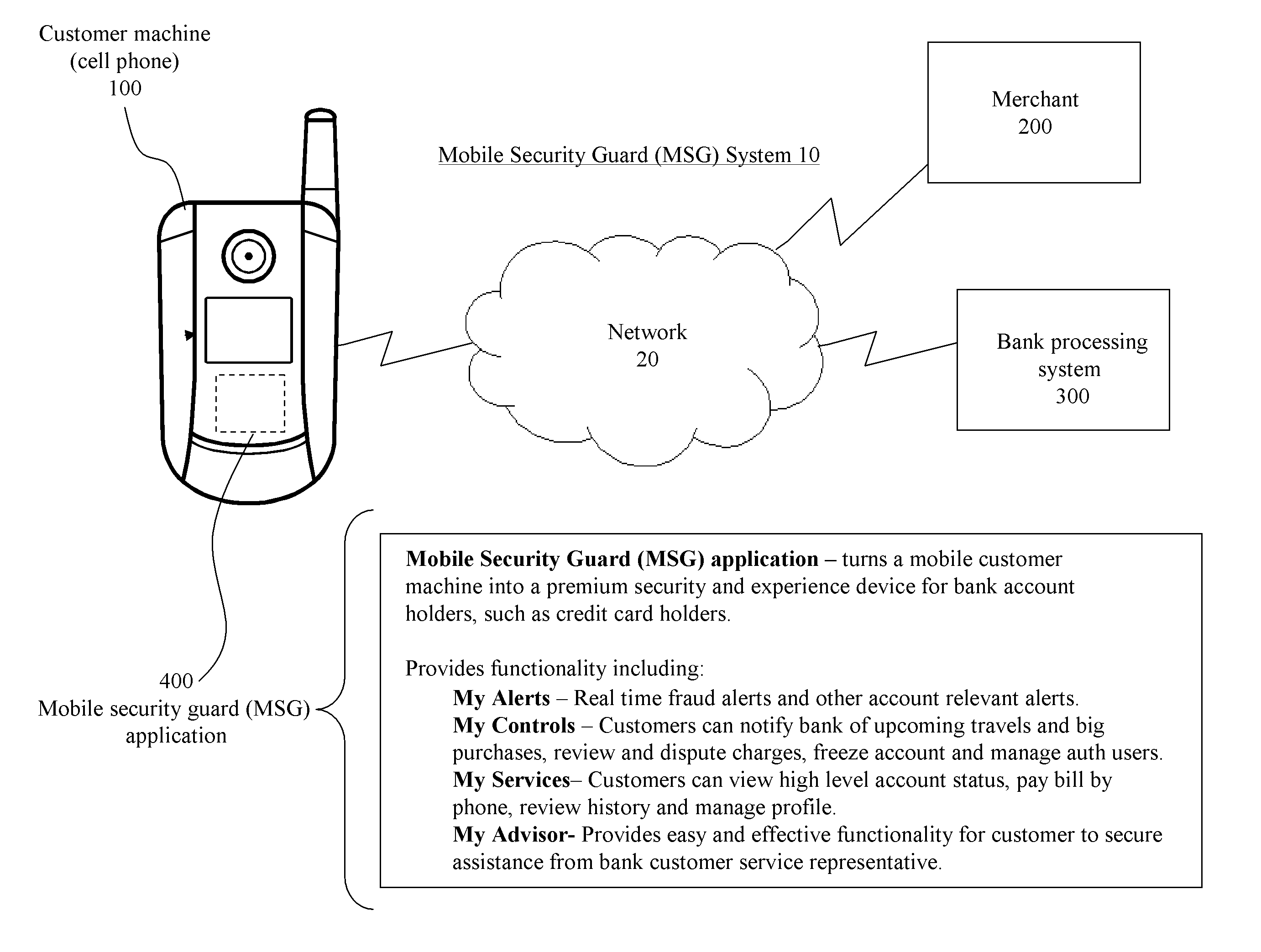

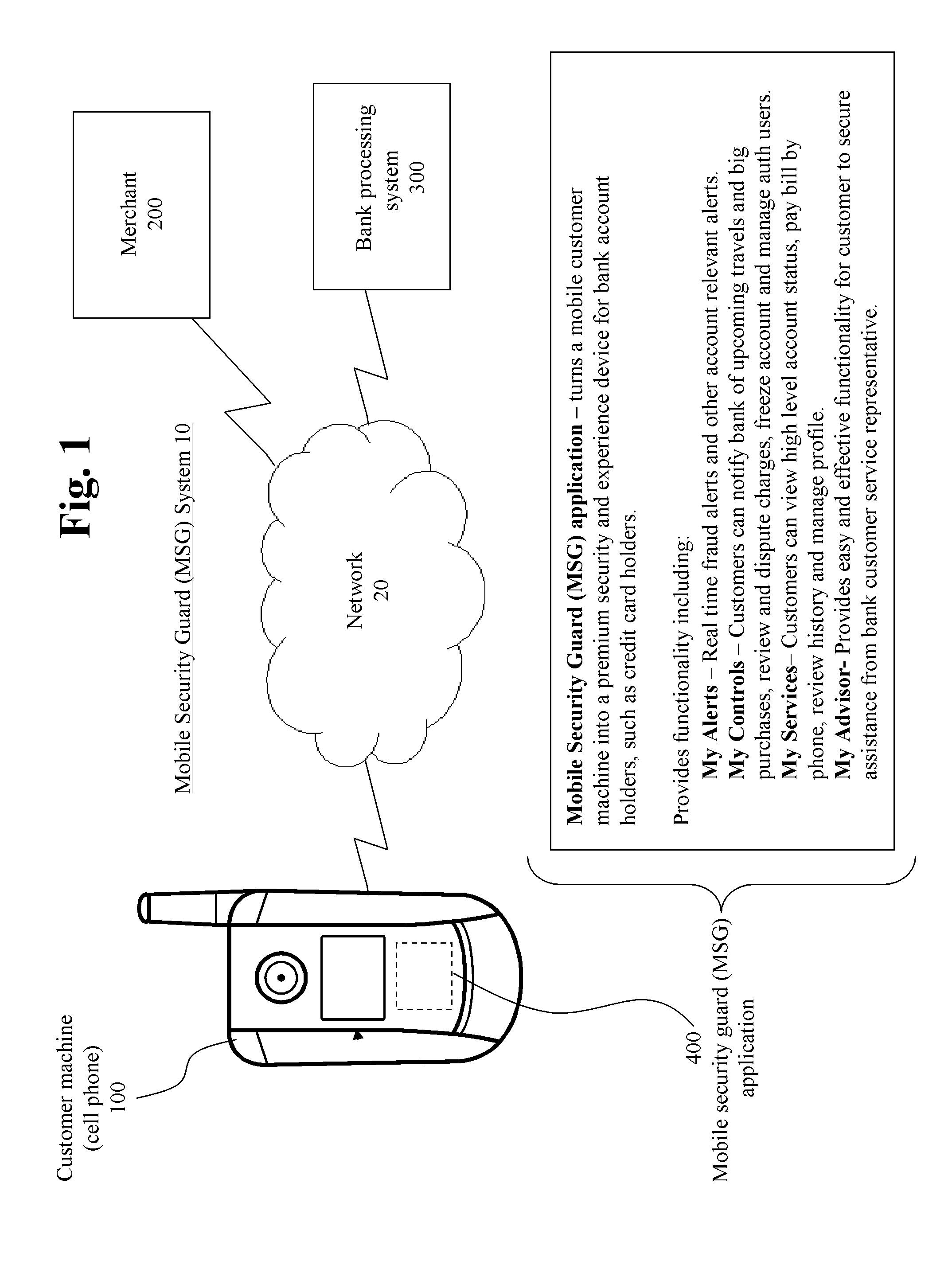

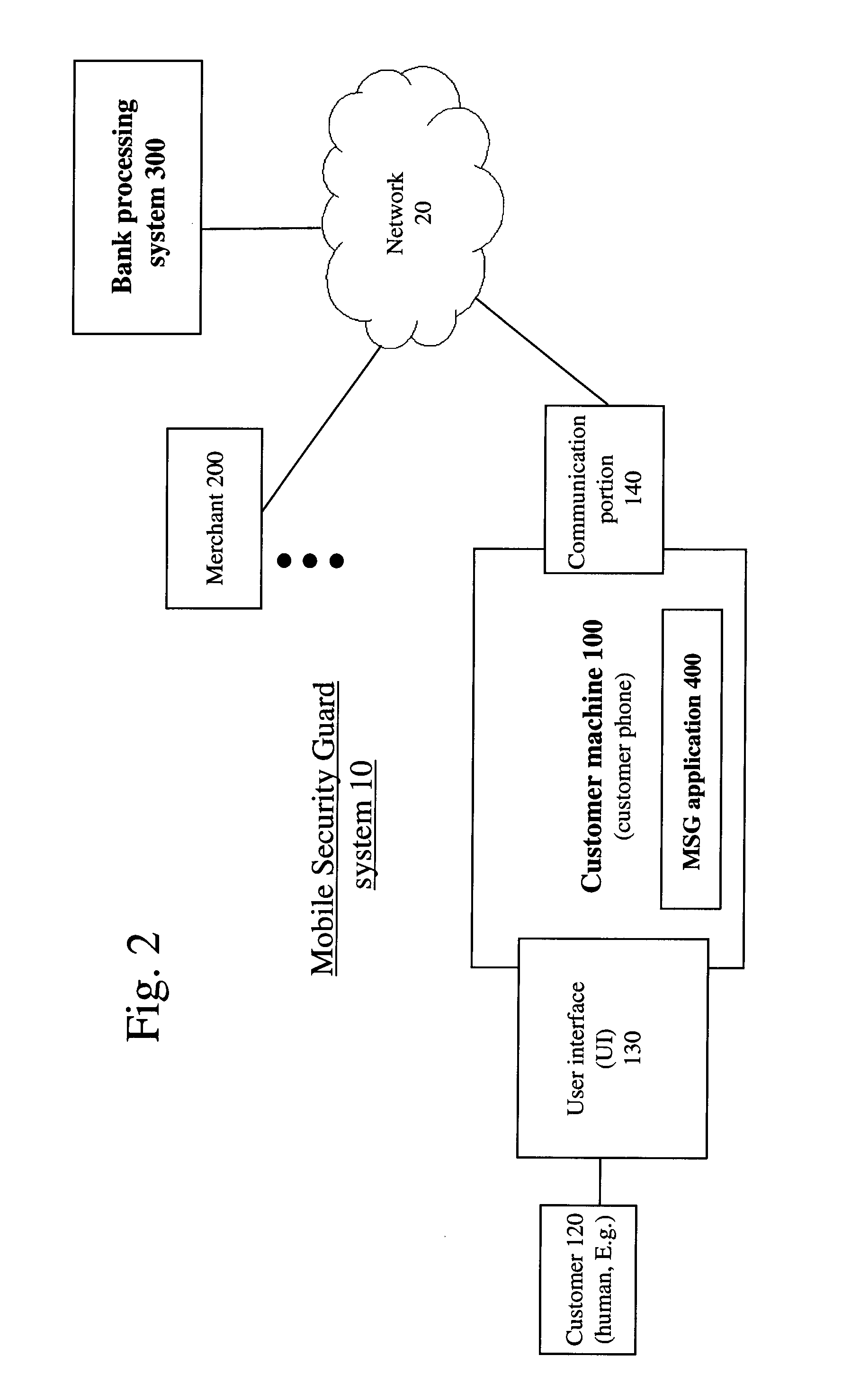

Systems and methods for providing a mobile financial platform

The invention provides systems and methods that provide a mobile banking platform to a user. The system may be in the form of an application disposed in a mobile customer machine, the application tangibly disposed in the form of code on a computer readable medium. The application may comprise a processing portion that interfaces with a human user and interfaces with a bank processing system, the processing portion providing financial related functionality relating to a financial account of the user, the processing portion: (1) inputting data related to the financial account from at least one of the user and from the bank processing system; (2) inputting a command related to the data; (3) performing processing on the data in response to the command; and (4) outputting a result based on the processing performed, the result output to at least one of the user and the bank processing system.

Owner:JPMORGAN CHASE BANK NA

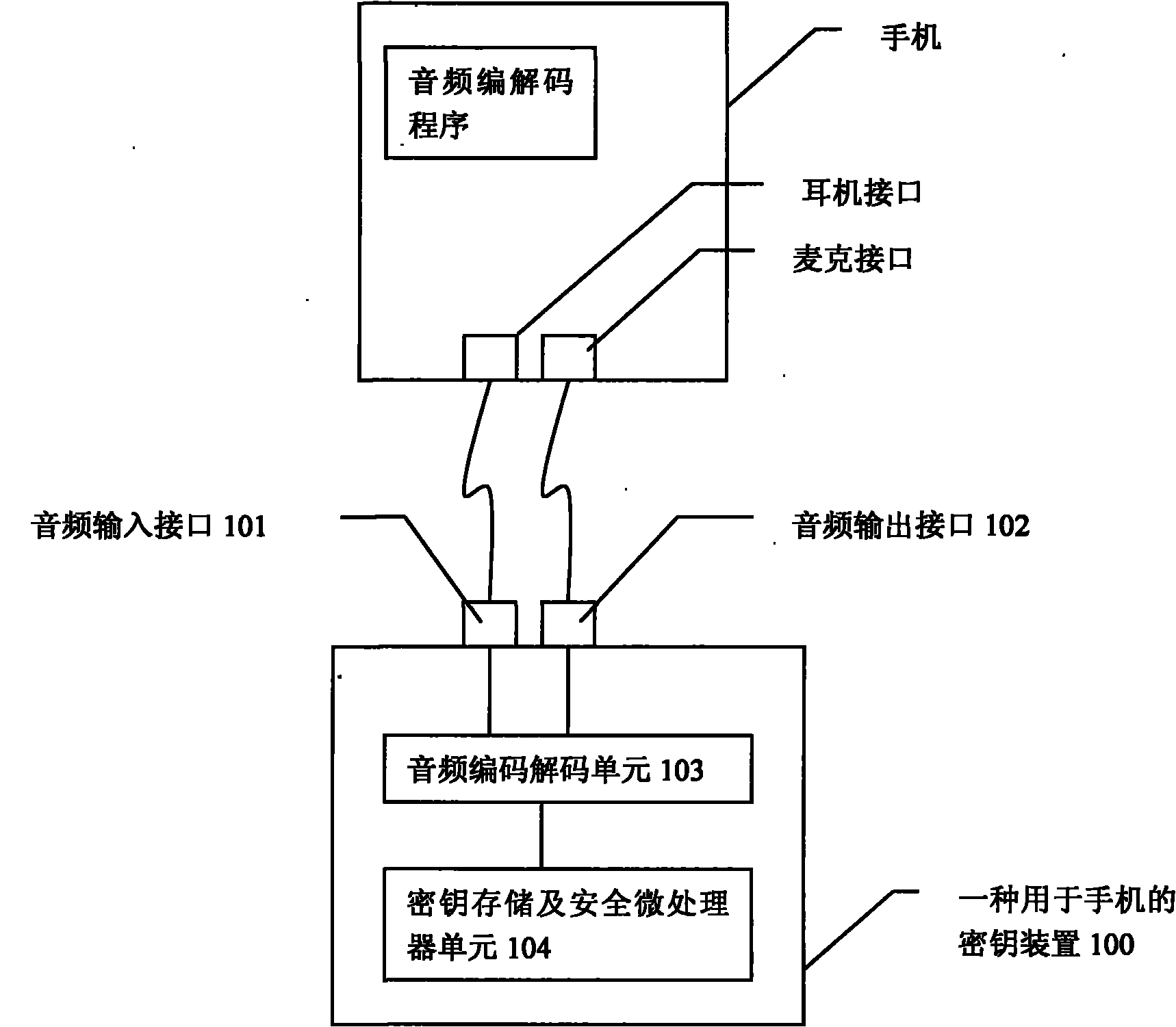

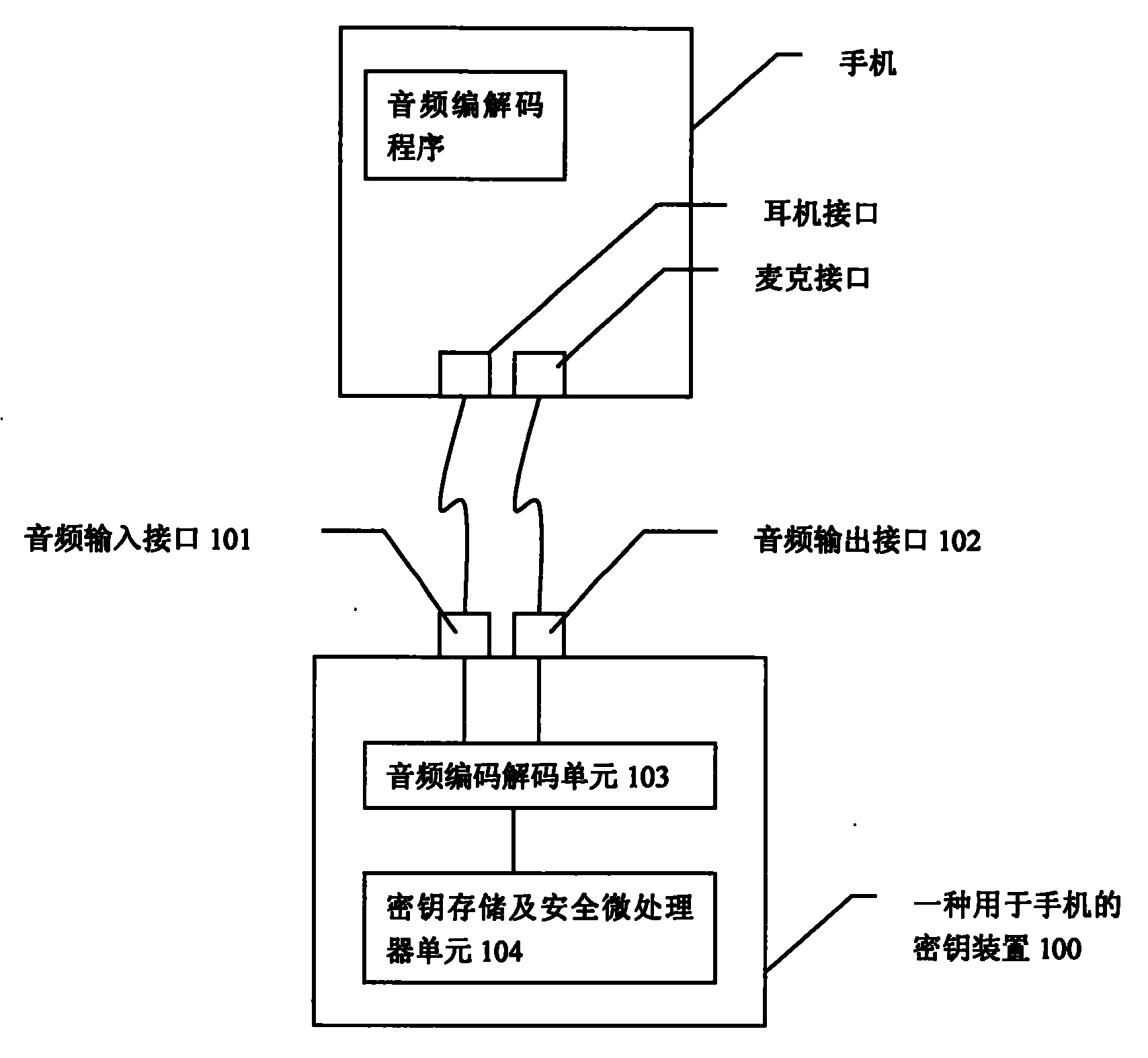

Secret key device and method for mobile phone

InactiveCN102098159AFirmly connectedUser identity/authority verificationSpeech analysisE-commerceHeadphones

The invention belongs to the fields of computers and finance, and in particular relates to secret key security storage, data encryption and authentication for applications of mobile banking services, electronic payment and electronic commerce on mobile phones. The invention discloses a secret key device and method for a mobile phone. The device is provided with an audio input interface, an audio output interface, an audio coder and decoder unit and a secret key storage and security microprocessor unit. The device can realize the functions of the secret key security storage, the data encryption and the authentication. The device can be communicated with a mobile phone and other mobile devices in an audio signal mode. When the device is connected with the mobile phone and the other mobile devices, the audio signal input interface of the device and the headphone interfaces of the mobile phone and the other mobile devices are connected, the audio signal output interface is connected with mic interfaces of the mobile phone and the other mobile devices, and audio data coder and decoder programs are arranged in the mobile phone and the other mobile devices respectively. The device can store one or more secret keys for data encryption and authentication. The secret keys stored in the device can not be read. The device can be applied to the mobile banking service, the mobile payment, the electronic commerce and other occasions requiring the secret key security storage, the data encryption and the authentication.

Owner:胡旭光

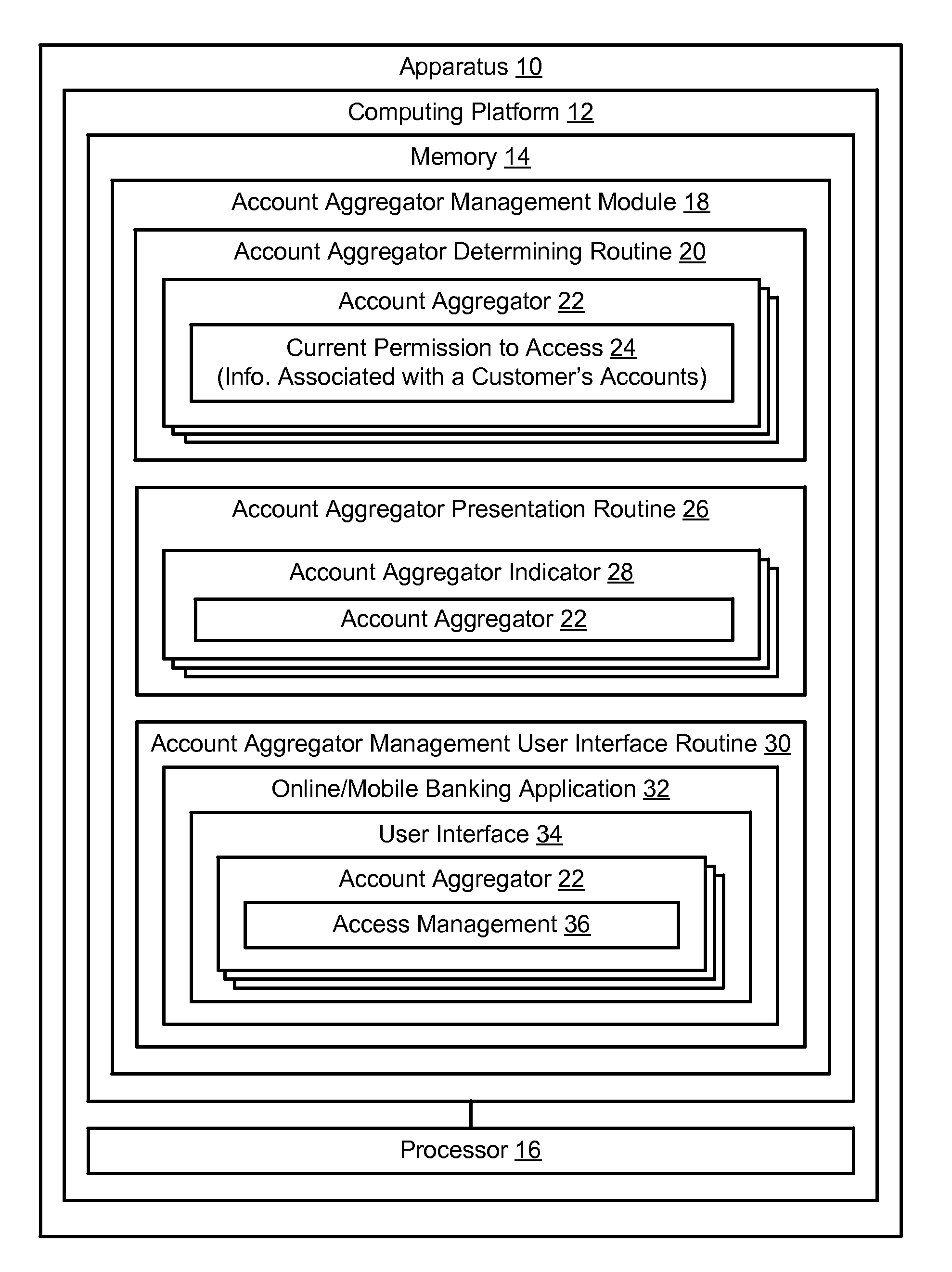

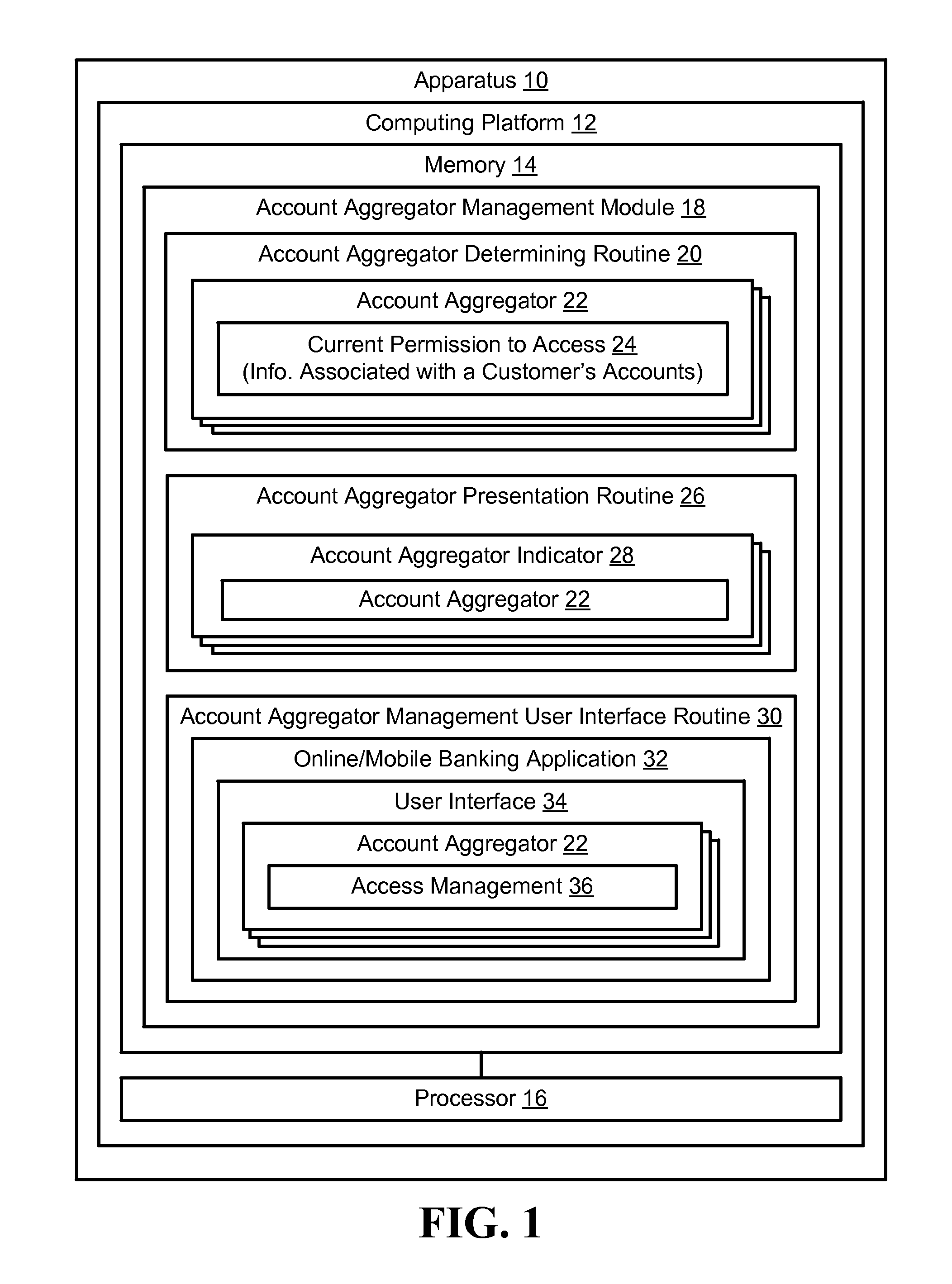

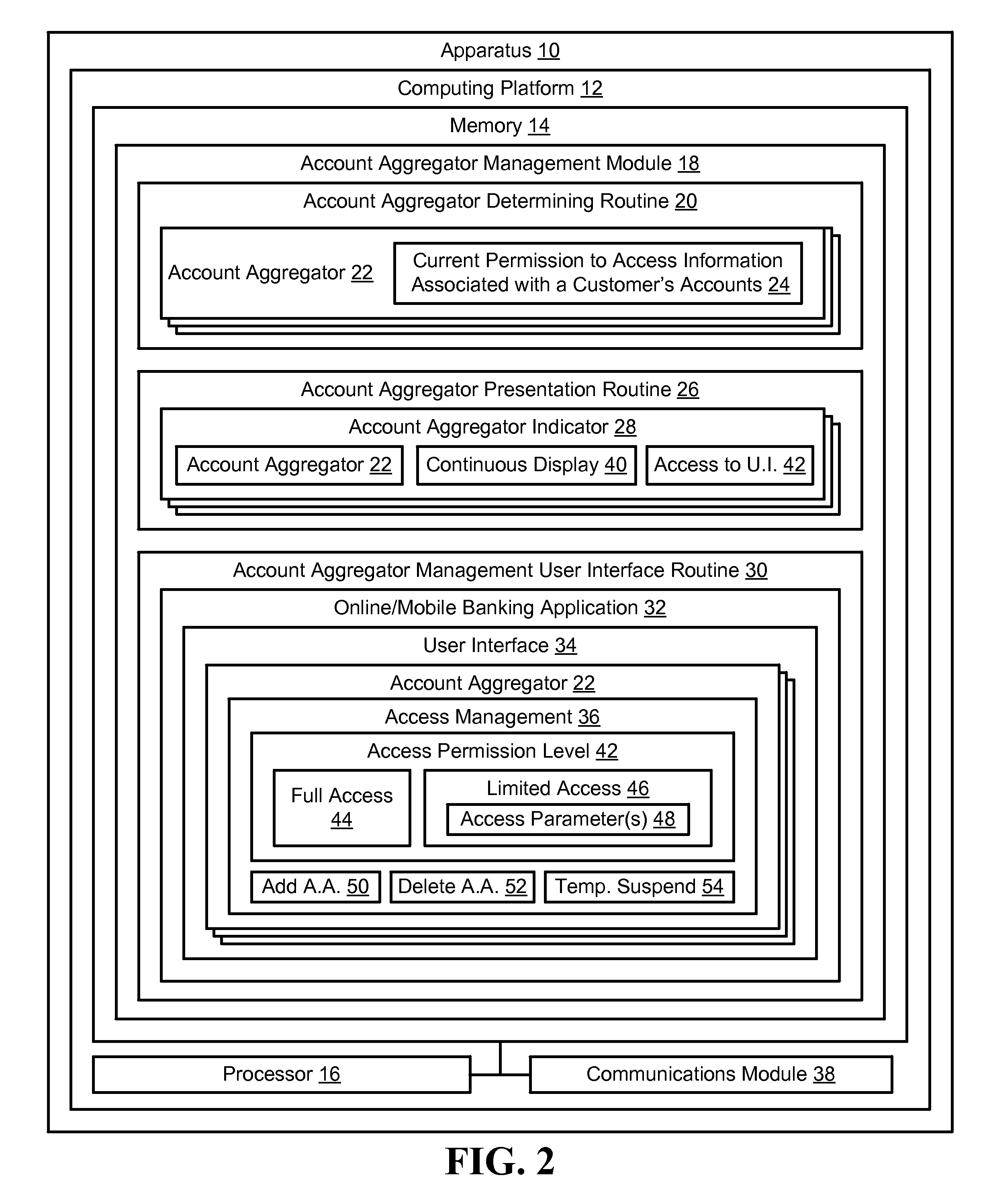

Systems for managing account aggregators access to financial account information

Embodiments of the invention are directed to apparatus, methods, and computer program products for determining and notifying a user, herein a financial institution customer, as to which account aggregators currently have been granted permission to access accounts held by the customer at the financial institution. In addition to notifying the customer of the current status of account aggregator access, the present invention provides the customer, through an online or mobile banking application or the like, a comprehensive tool for managing the access granted to all of the account aggregators that are determined to currently have permission to access the customer's accounts.

Owner:BANK OF AMERICA CORP

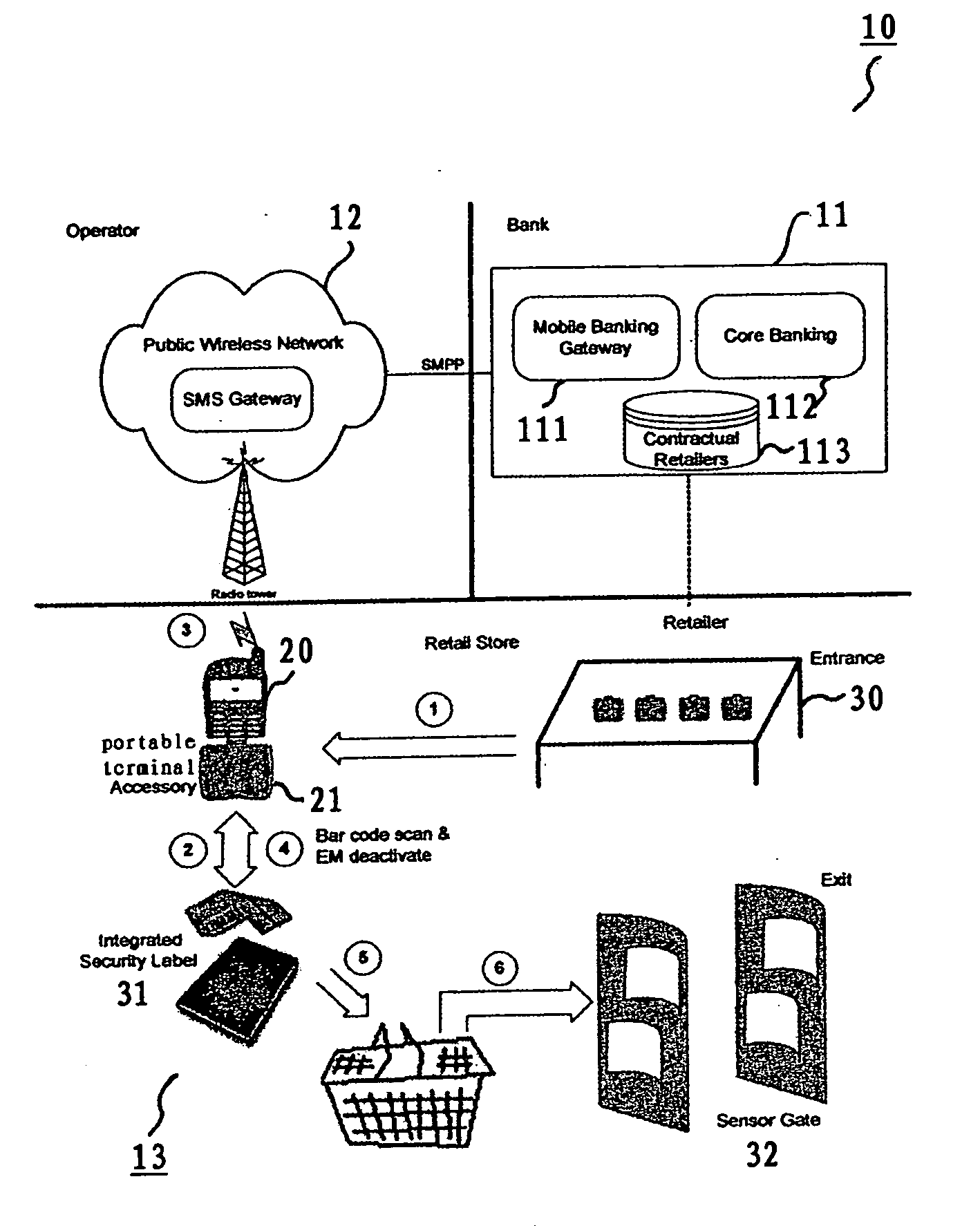

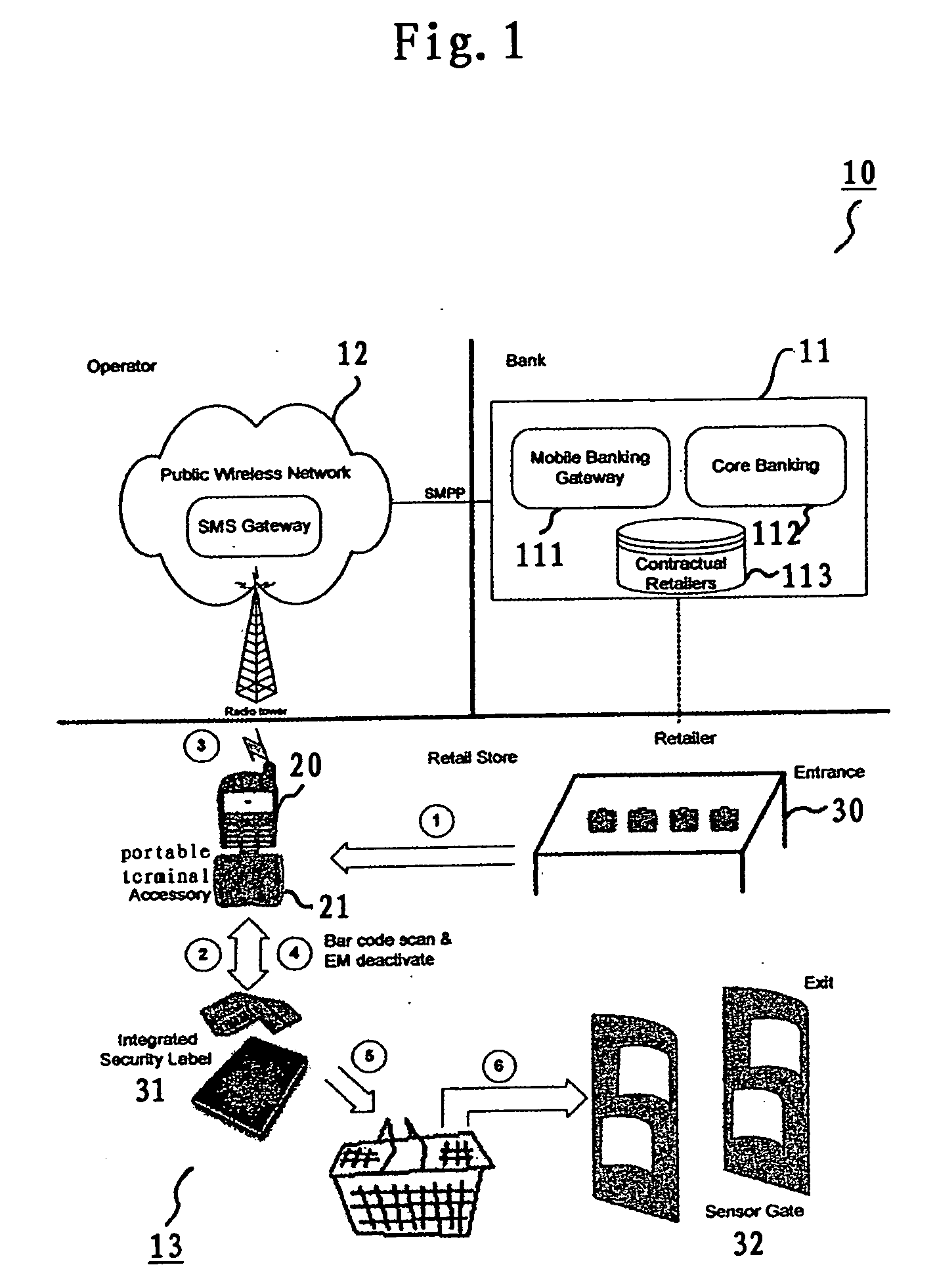

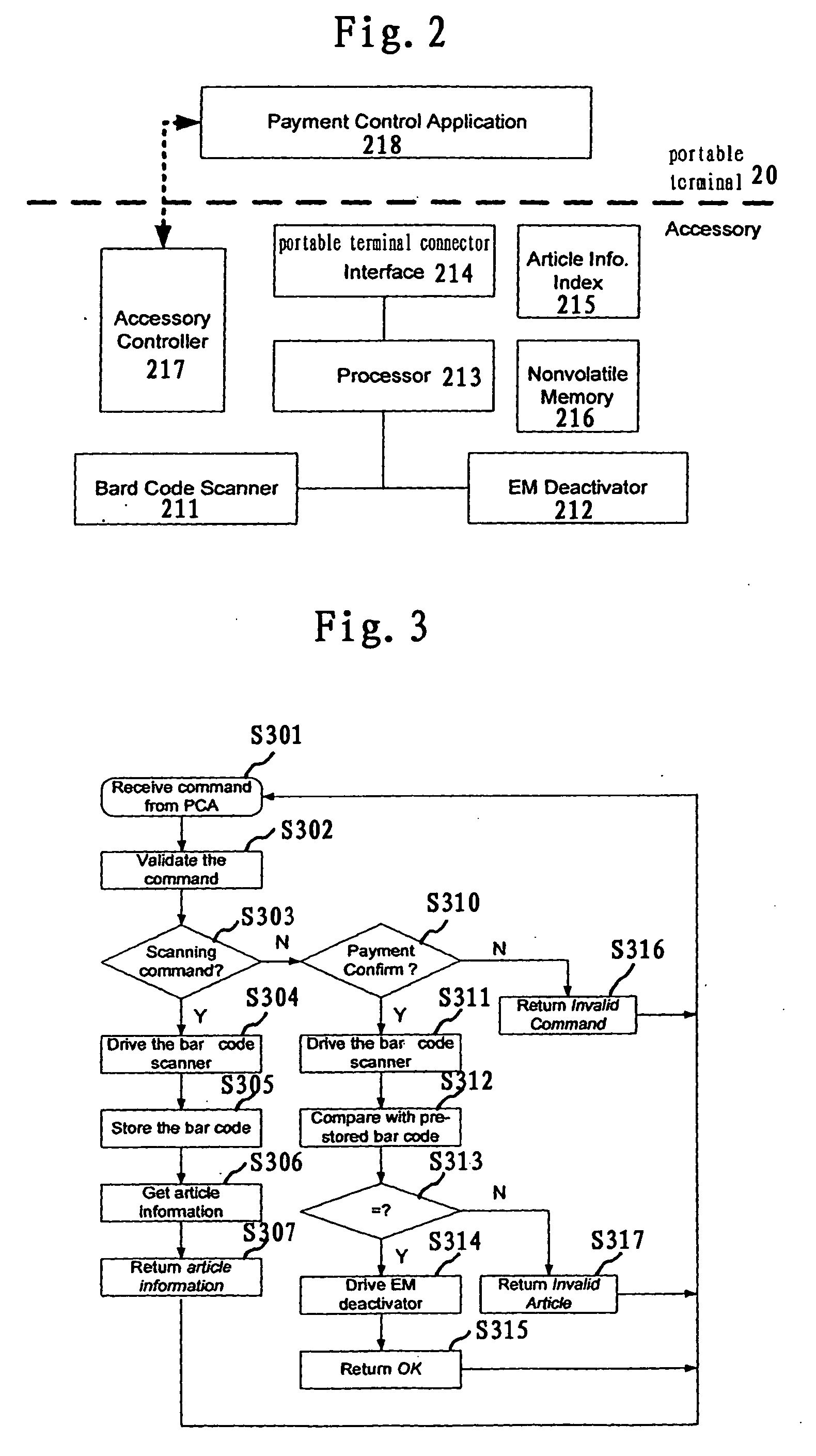

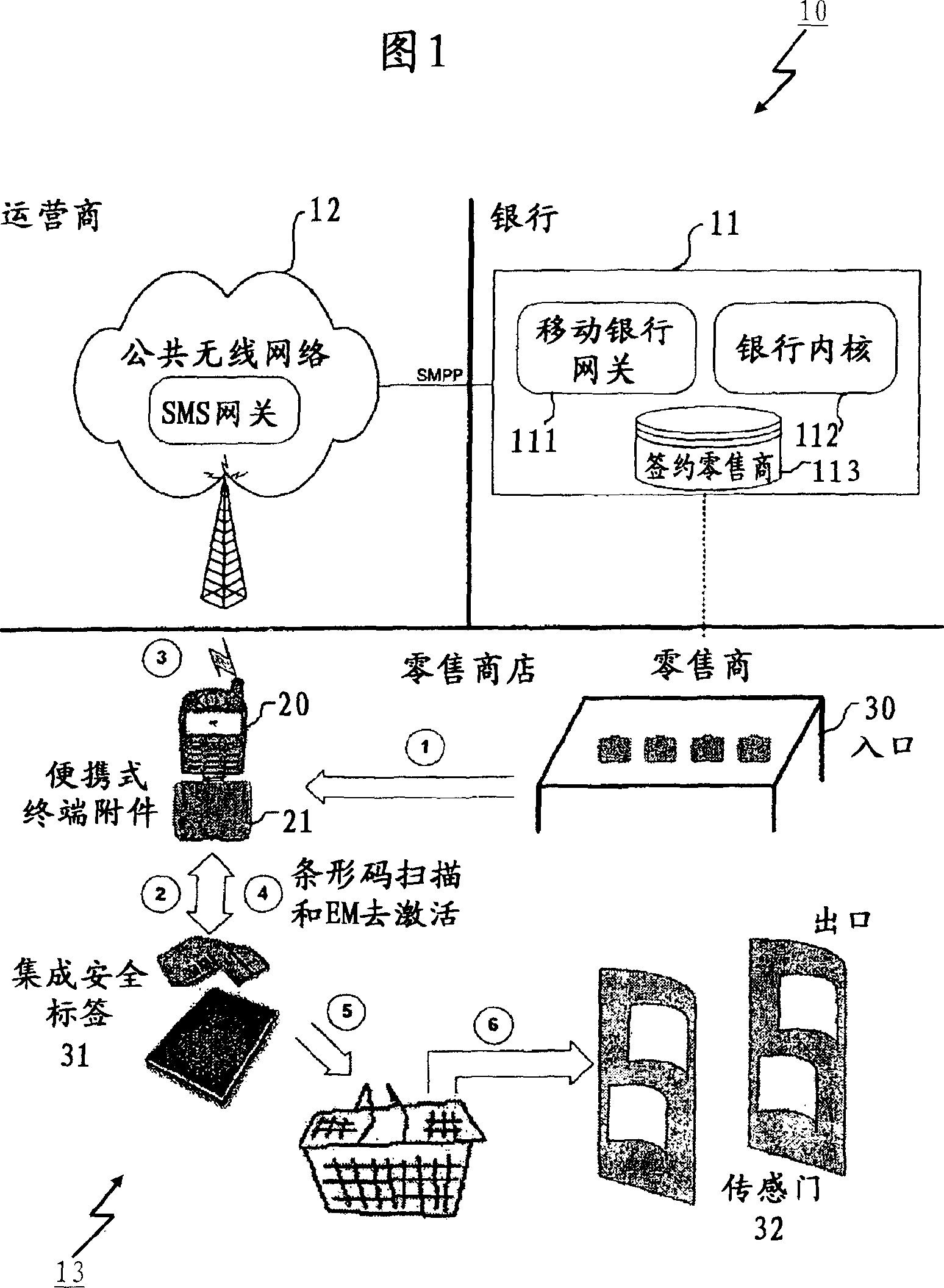

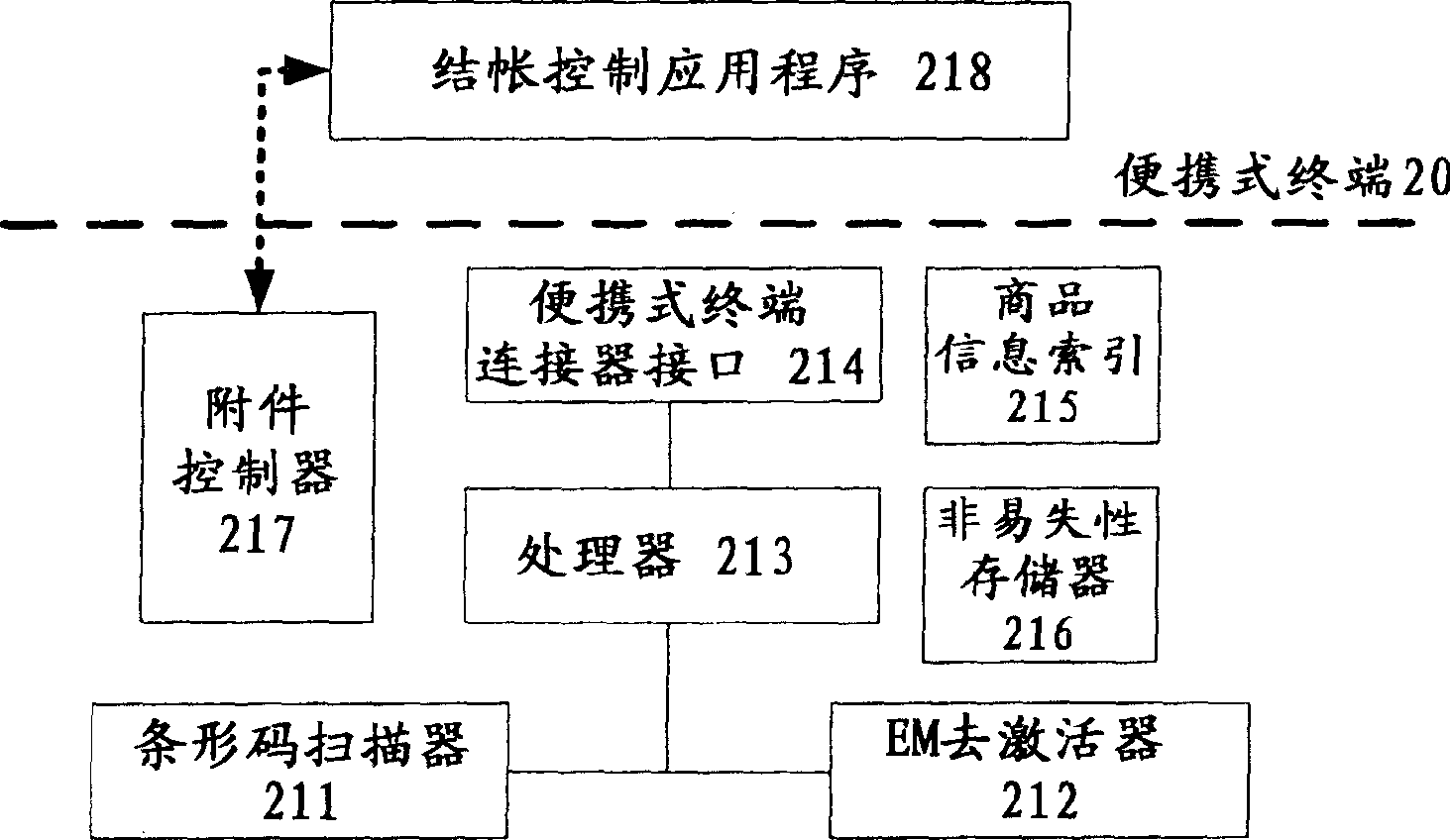

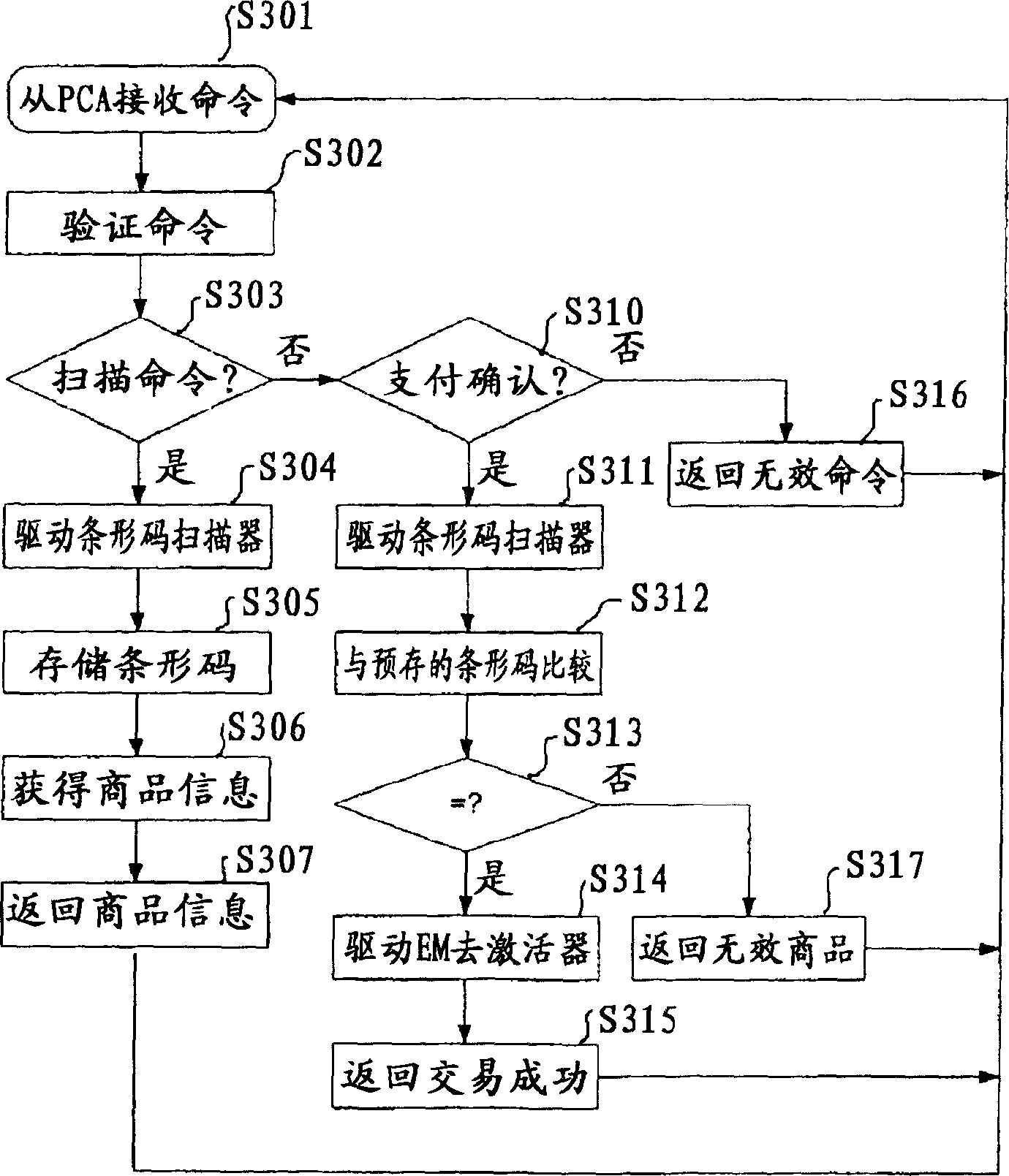

Mobile banking and anti-theft tag based smart portable checkout terminal, system, and method thereof

InactiveUS20060043175A1Reduce waiting timeReduce investmentCredit registering devices actuationCash registersComputer terminalEngineering

A mobile banking and anti-theft tag based portable checkout terminal, checkout system and checkout method for a retail environment are disclosed. A portable terminal accessory is designed for a portable terminal to acquire the article information related to the selected article that a customer in a retail environment wishes to purchase. The portable terminal is connected to the portable terminal accessory to receive the article information via scanning a tag attached to the article and to conduct the checkout processing with a customers bank through wireless communication.

Owner:IBM CORP

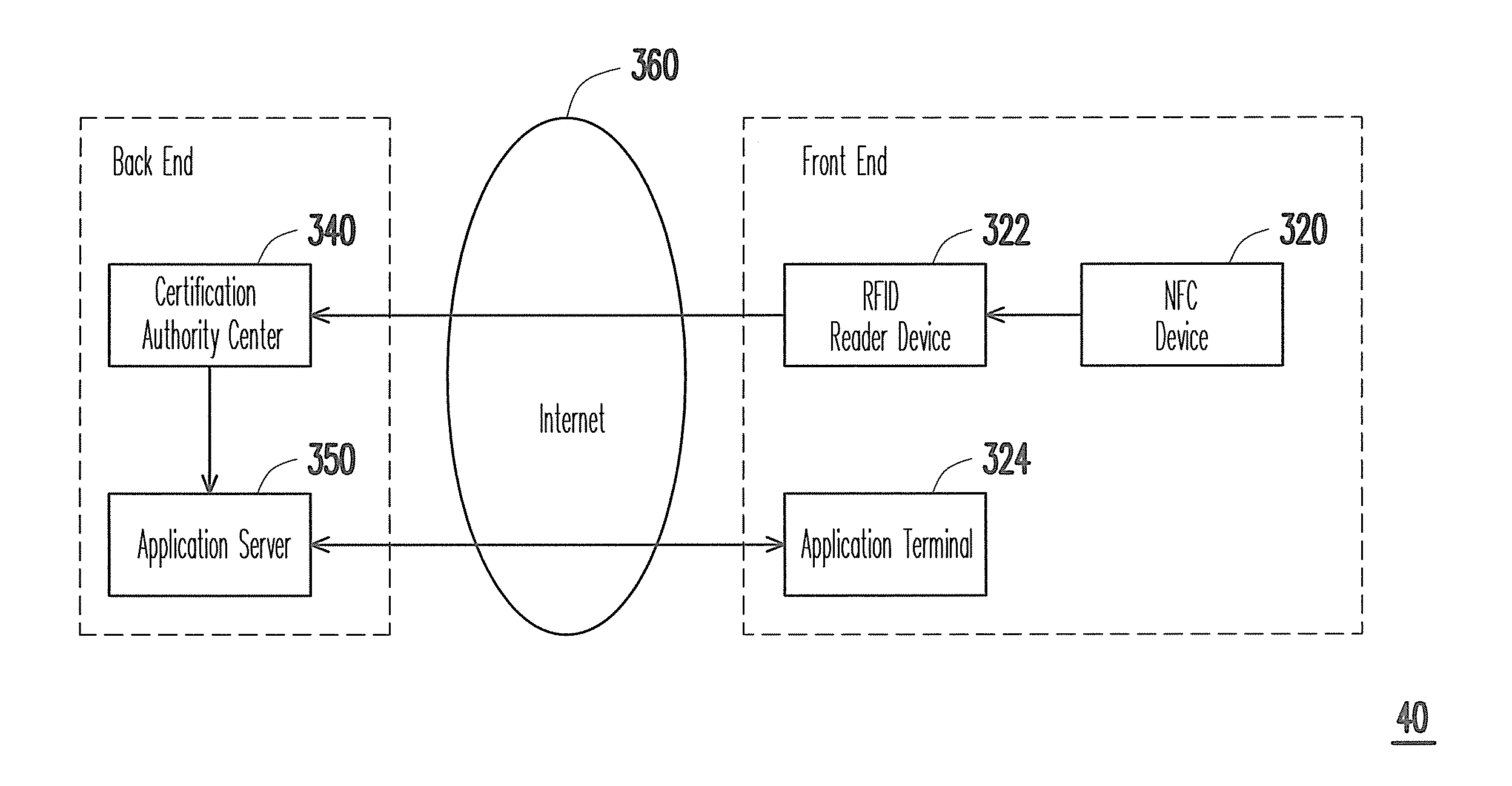

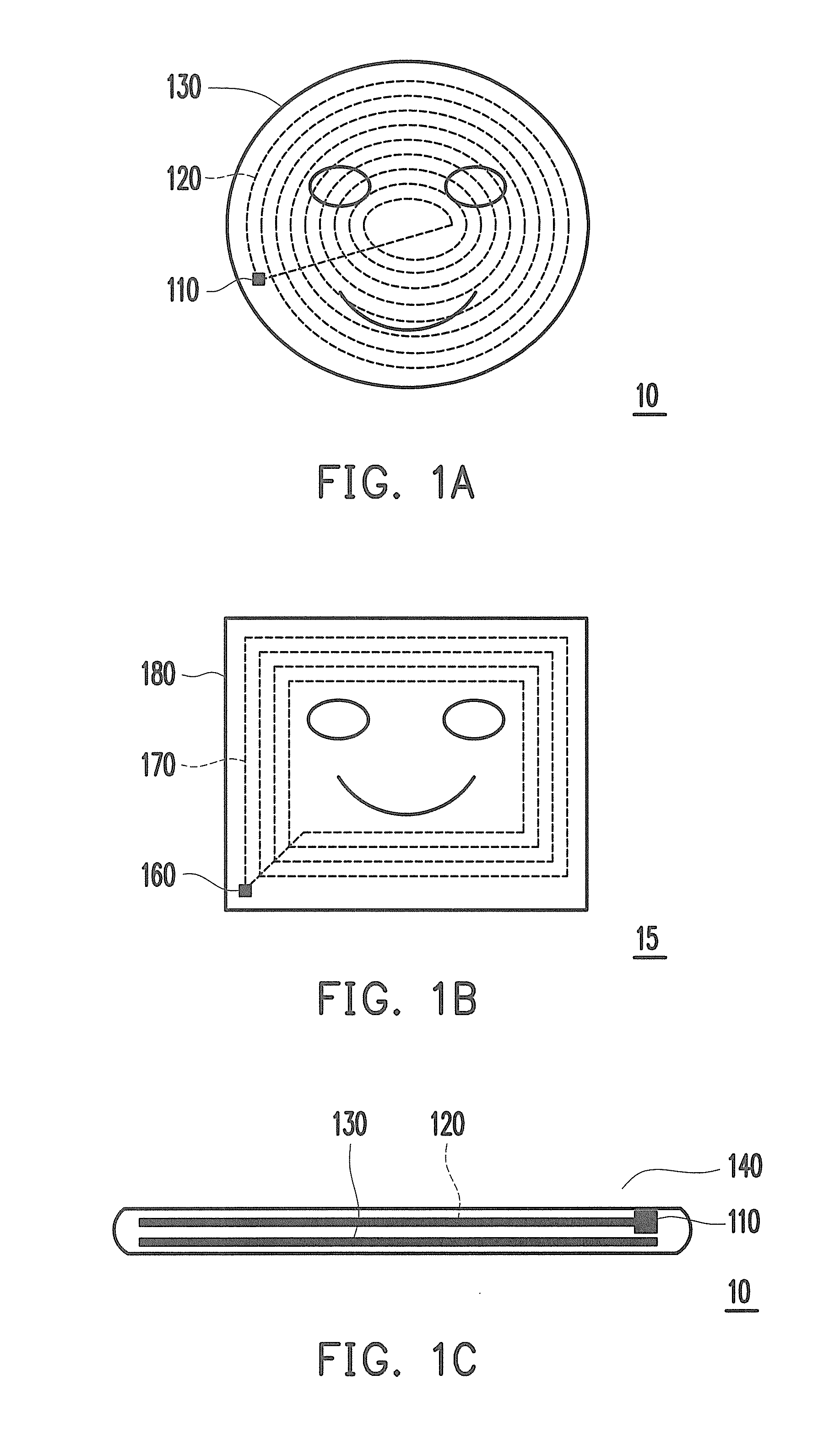

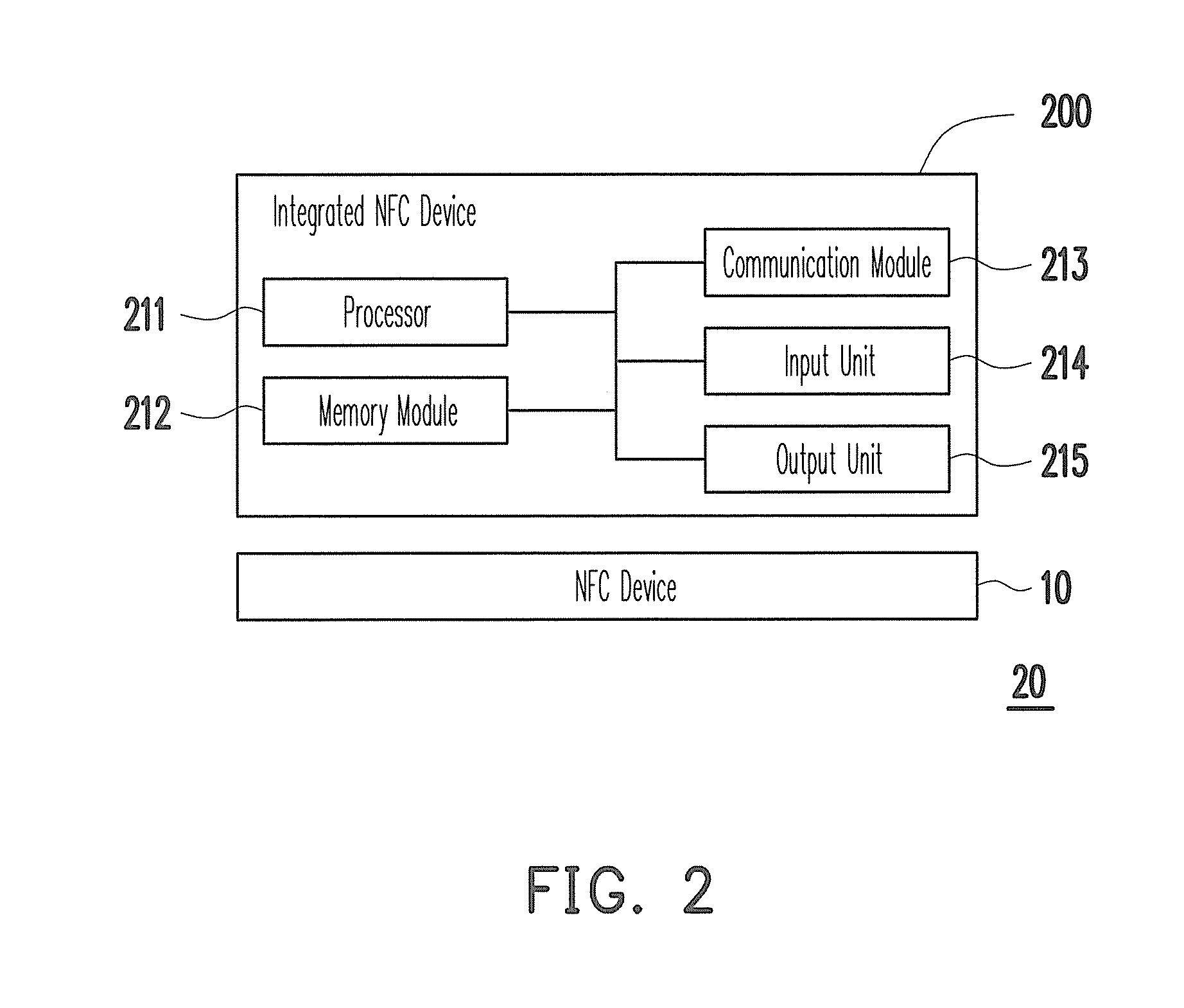

Near field communication device, authentication system using the same and authentication method thereof

ActiveUS20120061465A1Highly secure, reliable, and convenientAvoid interferencePayment architectureSensing record carriersComputer hardwarePack material

A near field communication (NFC) device, an authentication system using the NFC device and an authentication method thereof are provided. The NFC device includes a RFID tag, a loop antenna, a flexible fabric packaging material and an EMI shielding material. The device can be easily adhered to objects including most handsets for mobile phone services. By adopting the authentication system and the authentication method, the device can be paired with a typical mobile phone and used to authenticate the user, thereby enabling mobile payment and mobile banking activities using mobile phones.

Owner:LUO MINSKY

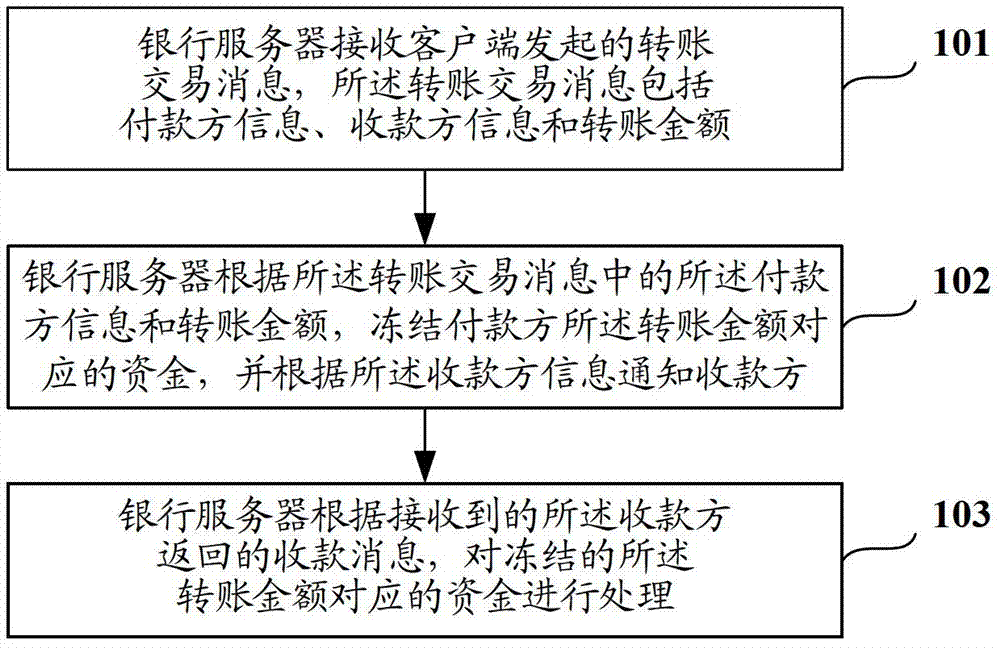

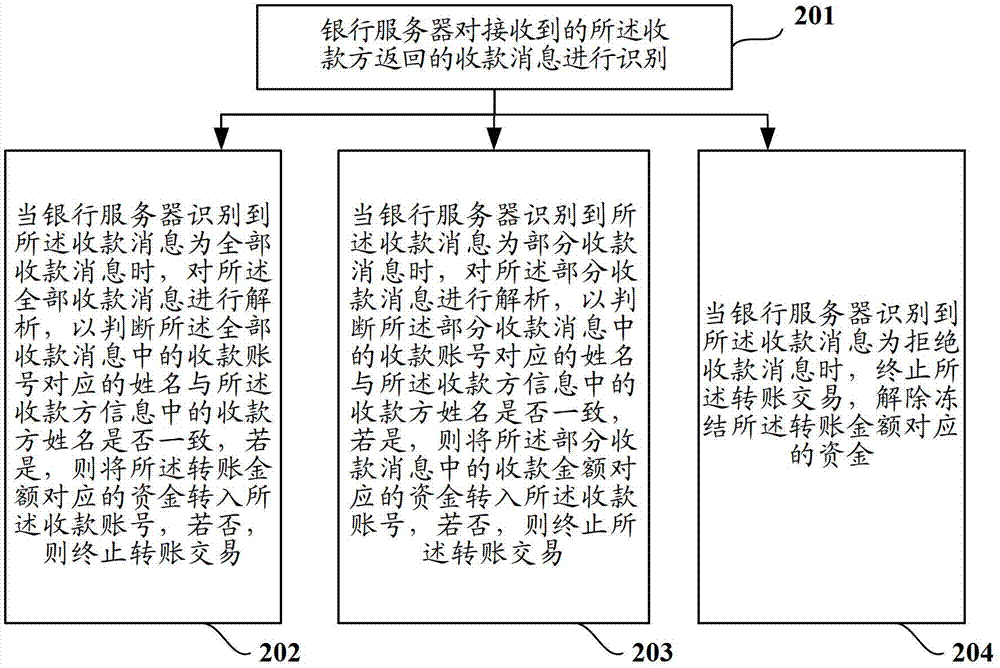

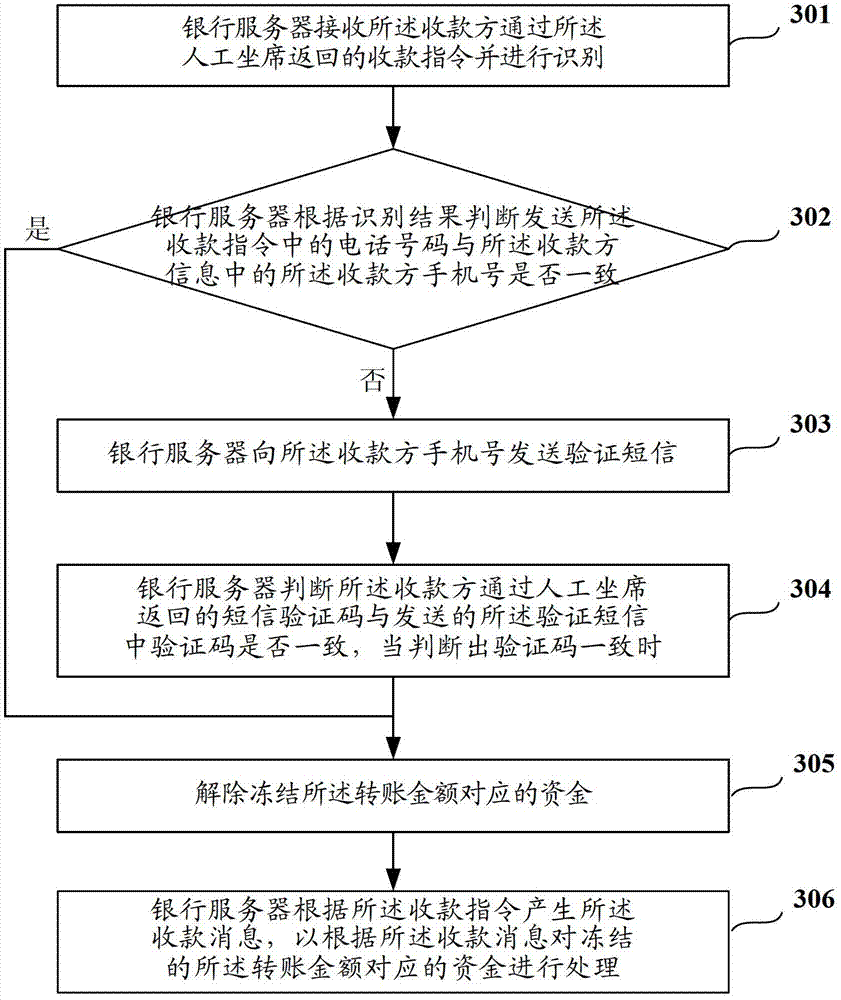

Transfer data processing method and device

The invention provides a transfer data processing method and a device. The method includes that transfer trade information transmitted by a user side is received, the transfer trade information comprises player information, payee information and transfer amount, according to the player information and the transfer amount in the transfer trade information, fund corresponding to the transfer amount of a player is frozen, and a payee is informed according to the player information. According to received collection information returned by the payee, and the frozen fund corresponding to the transfer amount is processed. The transfer data processing method and the device can achieve the fact an account number of a bank which does not open mobile banking business can conduct account-transfer and interbank-transfer, and the controllability for transfer transaction of the payee is improved.

Owner:MINSHENG BANKING CORP

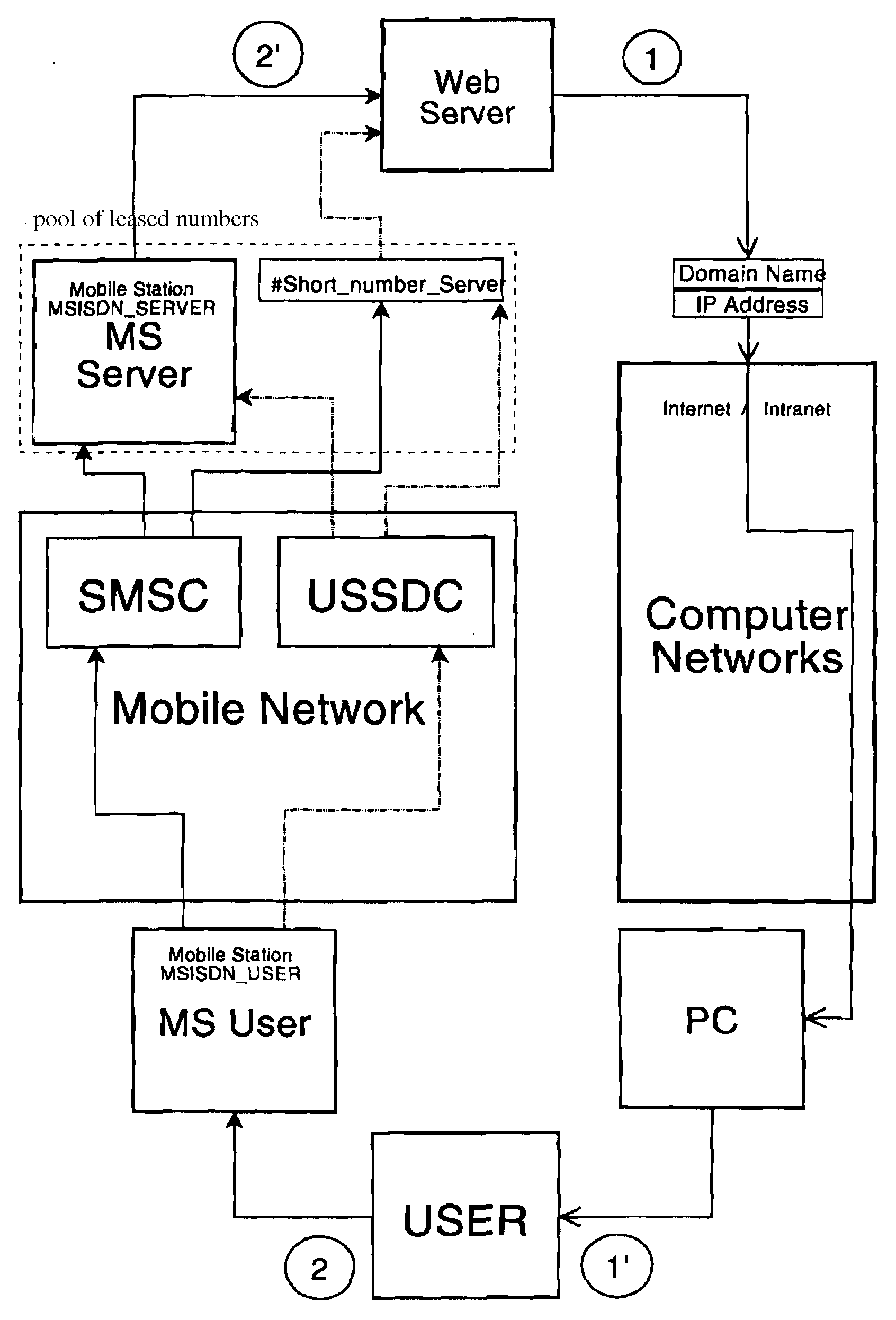

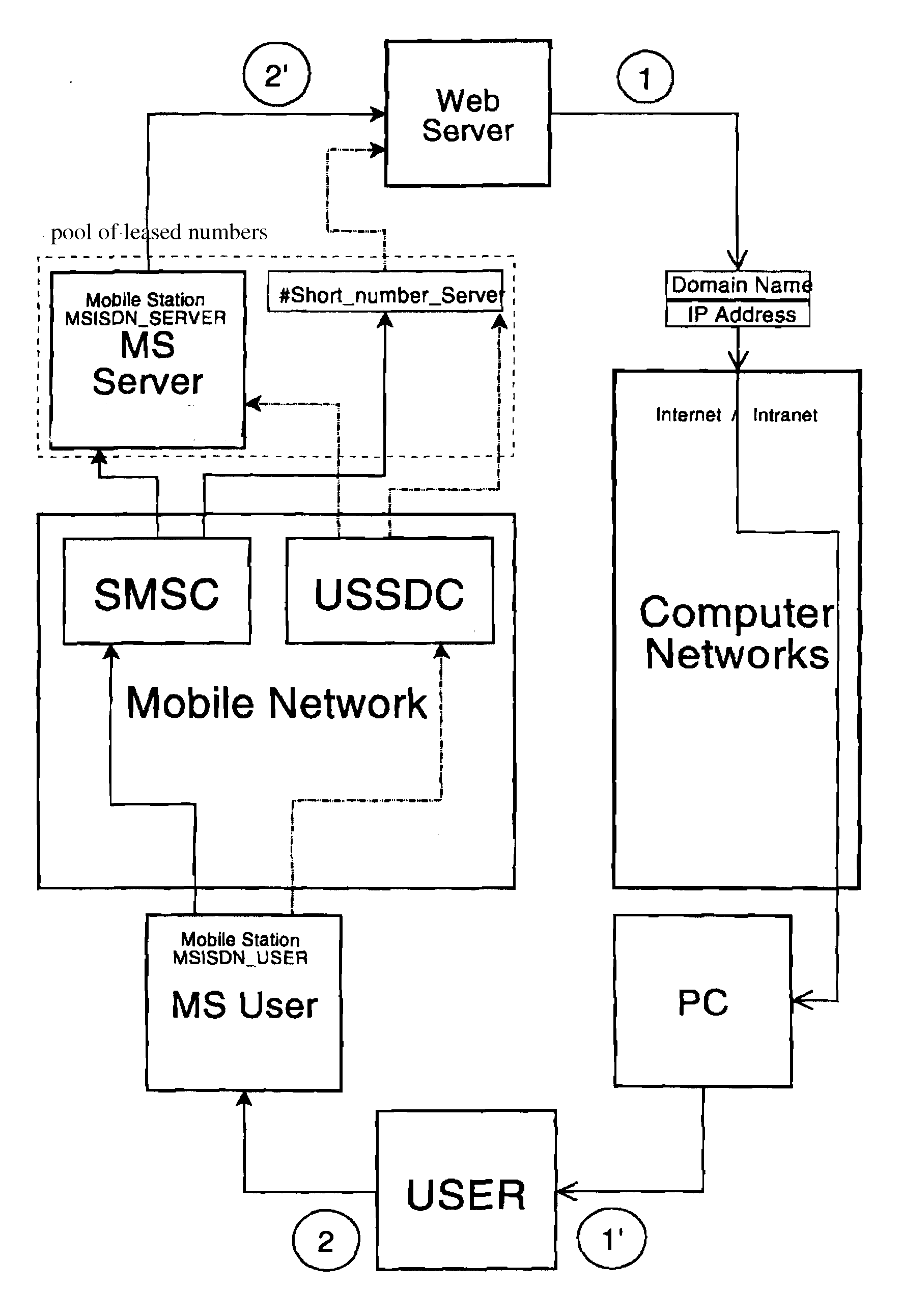

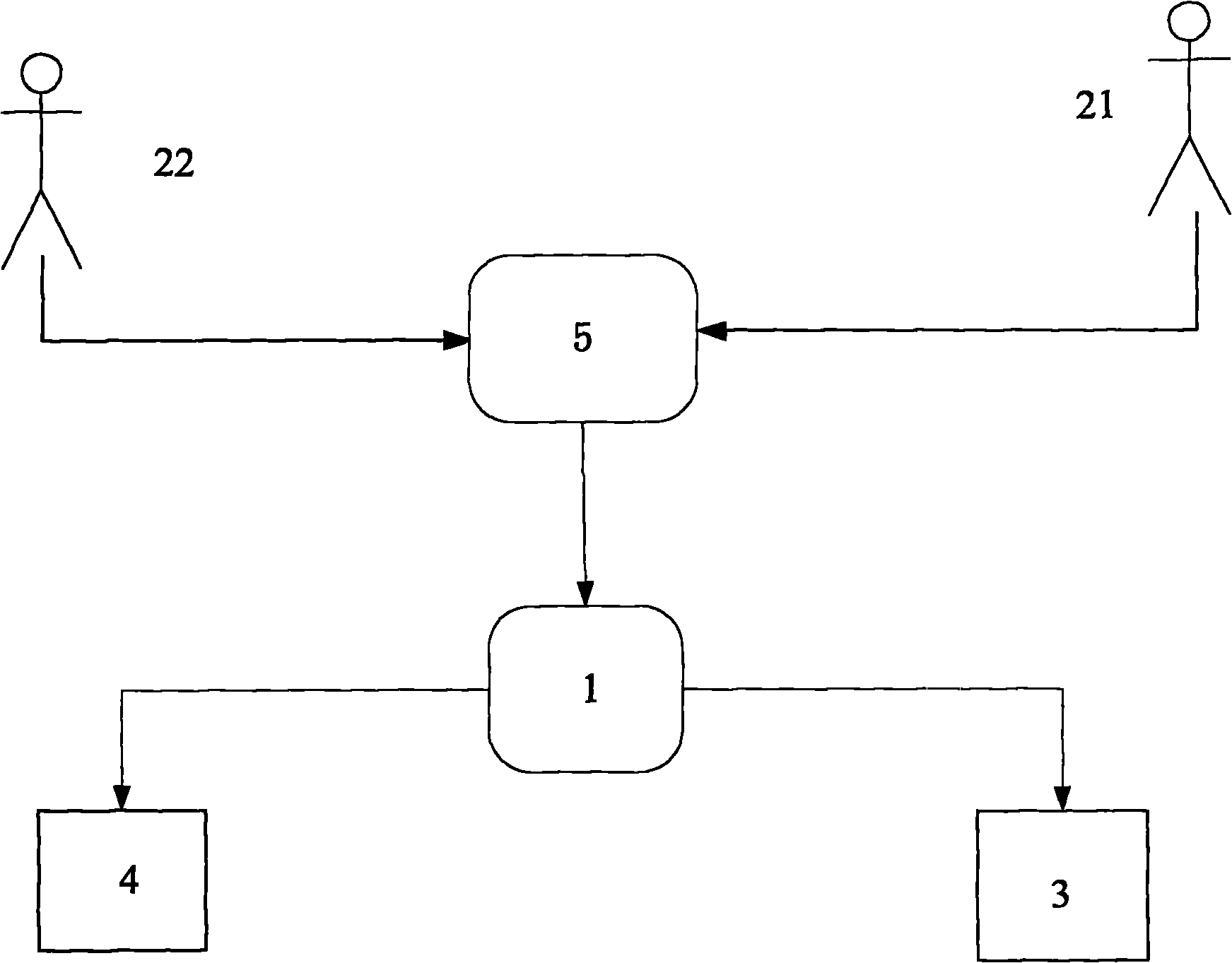

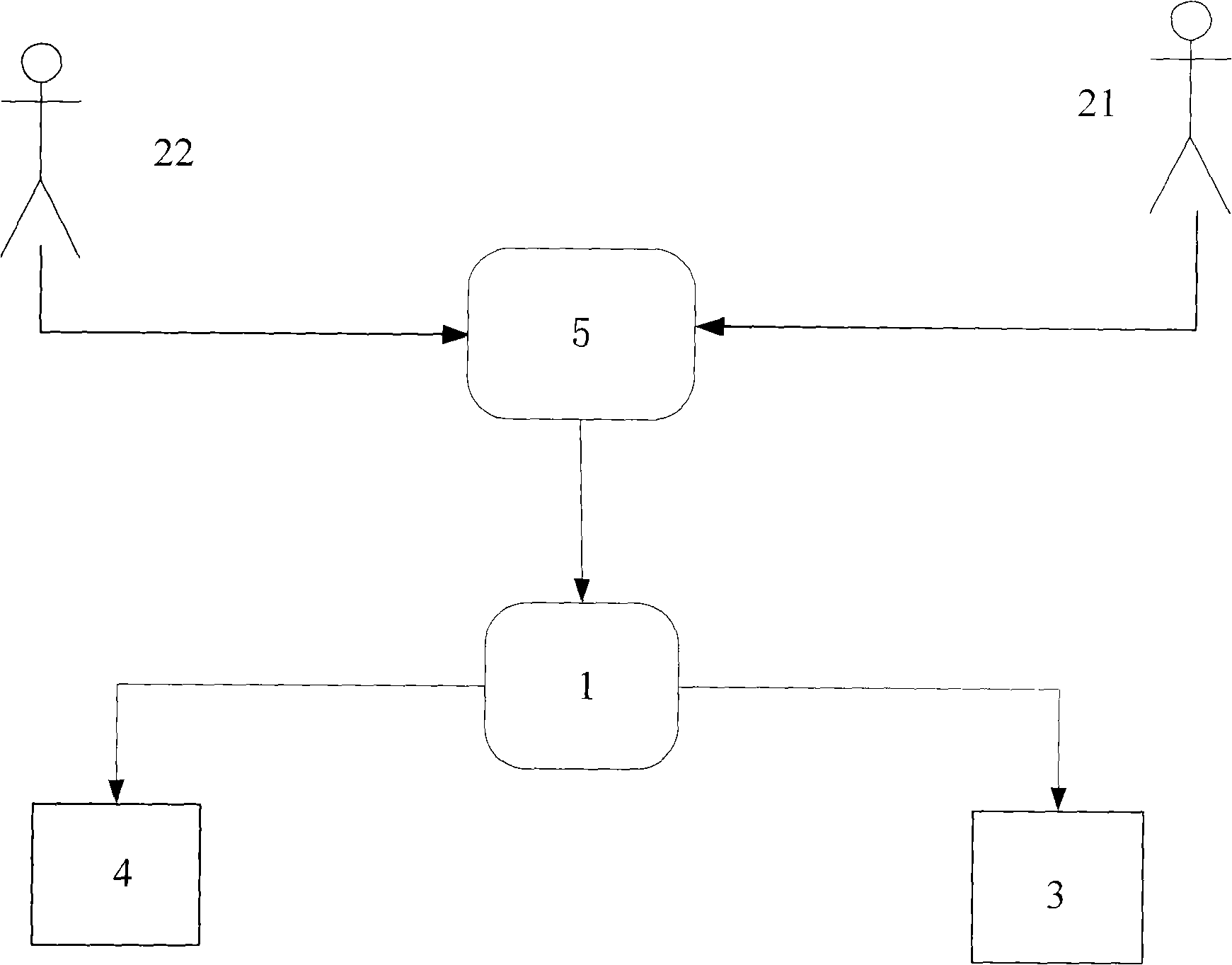

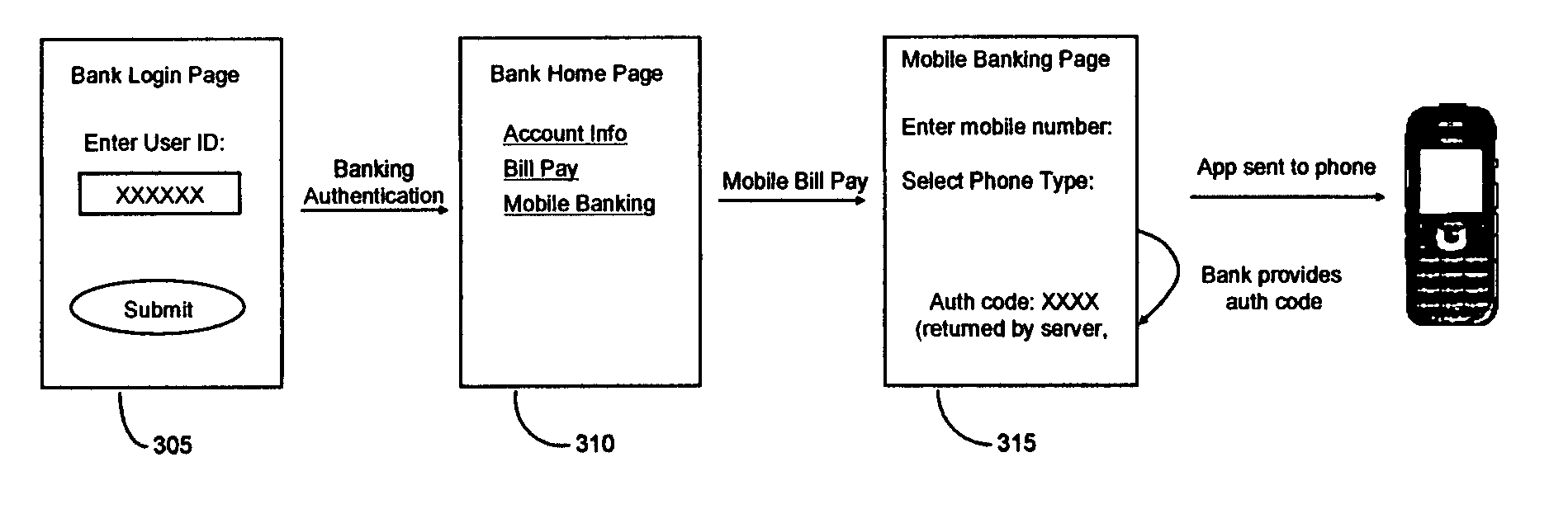

Process of remote user authentication in computer networks to perform the cellphone-assisted secure transactions

InactiveUS20110131638A1Digital data processing detailsUser identity/authority verificationPaymentFinancial transaction

This invention relates to processes of personal user authentication in computer and mobile wireless communications networks to perform transactions including payments. The process provides remote user authentication in various computer networks, the Internet inclusive, to perform secure transactions such as e-commerce and remote banking (on-line banking, remote banking, direct banking, home banking, internet banking, PC banking, phone banking, mobile-banking, WAP-banking, SMS-banking, GSM-banking, TV banking).

Owner:KAN DMITRY I

Bank transfer method by using mobile phone

The present invention relates to a bank transfer method by using a mobile phone, comprising the steps that: (1) the payer opens a mobile phone banking service; (2) the payer logins a mobile phone banking system and selects a bank card account as transfer account; (3) the payer inputs the mobile phone number of the payee, the mobile phone banking system judges whether the mobile phone number is registered in the mobile phone banking system or not; a. if the mobile phone number is registered, the mobile phone banking system calls the payer to fill the transfer information and completes the transfer if the information is legal; b. if the mobile phone number is not registered, the mobile phone banking system sends a push short message to the payee through an interface provided by a short message service center, the push short message includes an link, the payee gets the relevant page through the link and completes the transfer if the information is right. Compared with the traditional bank transfer and internet bank transfer, the invention has the advantages of better interactivity between the mobile phone and the computer network of a bank, rapid data transmission, available use, convenience, safety and reliability.

Owner:CHINA EVERBRIGHT BANK

Device, system, and method for mobile convergence payment

InactiveCN104881779AOpen online and offline paymentRealize the transaction closed loopDigital data authenticationProtocol authorisationPayment transactionClosed loop

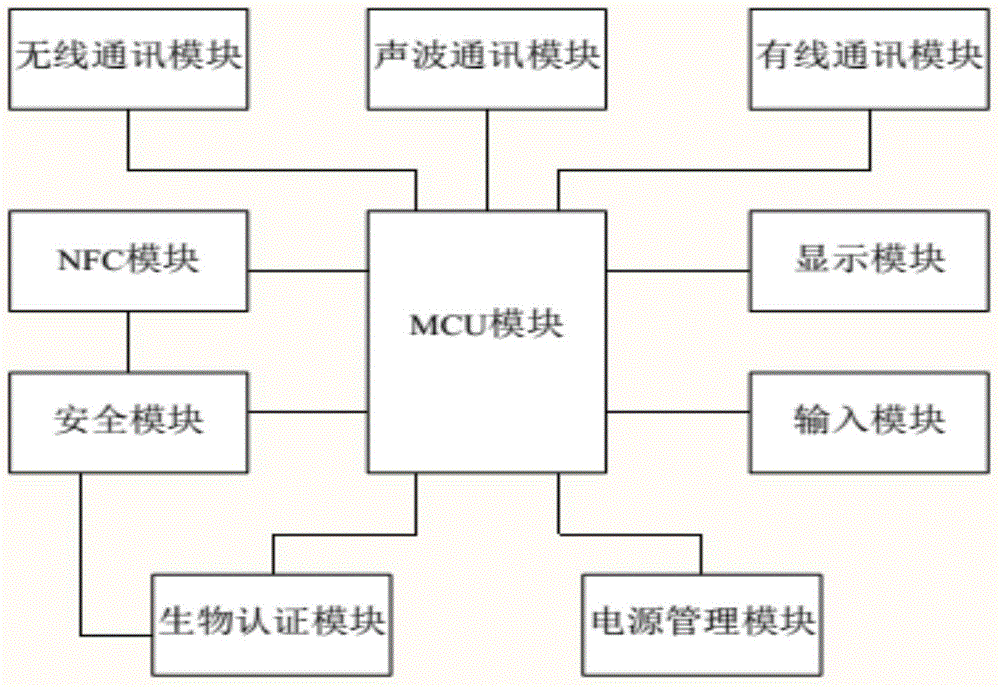

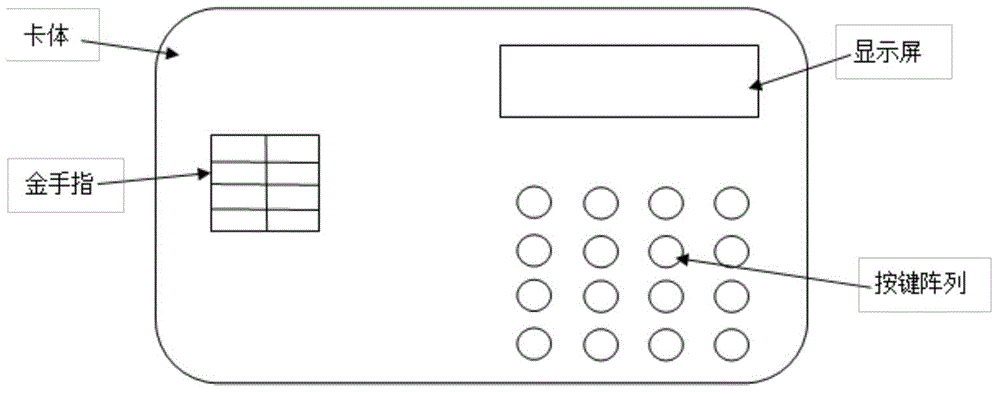

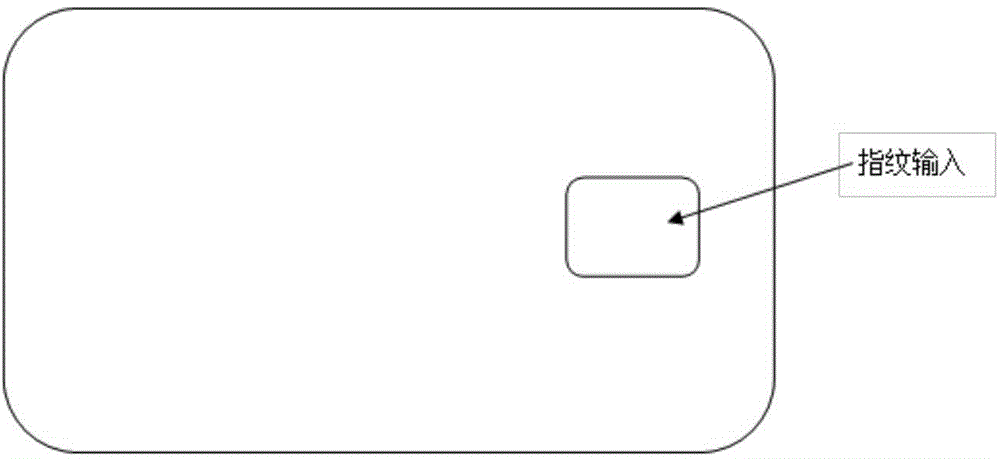

The invention relates to a device, a system, and a method for mobile convergence payment. The device comprises a MCU module, a safety module, a communication module, an NFC module, an input module, a display module, and a power management module. The safety module, the communication module, the NFC module, the input module, the display module, and the power management module are connected with the MCU module. The NFC module is connected with the safety module. The communication module at least comprises two kinds of communication channels. The device is provided with a plurality of safety submodules, and can effectively protect user transaction safety through implementing a safety payment transaction method, an electronic authentication method, and a plurality of safety data transmission methods. The device, the system, and the method are suitable to be used for online banking service, mobile banking service, industry IC card recharging service, IC card card-present payment service, and near-field payment service, and other applications. The device can be used offline, and can also be used online, and effectively gets through online and offline payment, realizes transaction closed loop. The device, the system, and the method can be used for various kinds of payment application scenarios.

Owner:HENGBAO

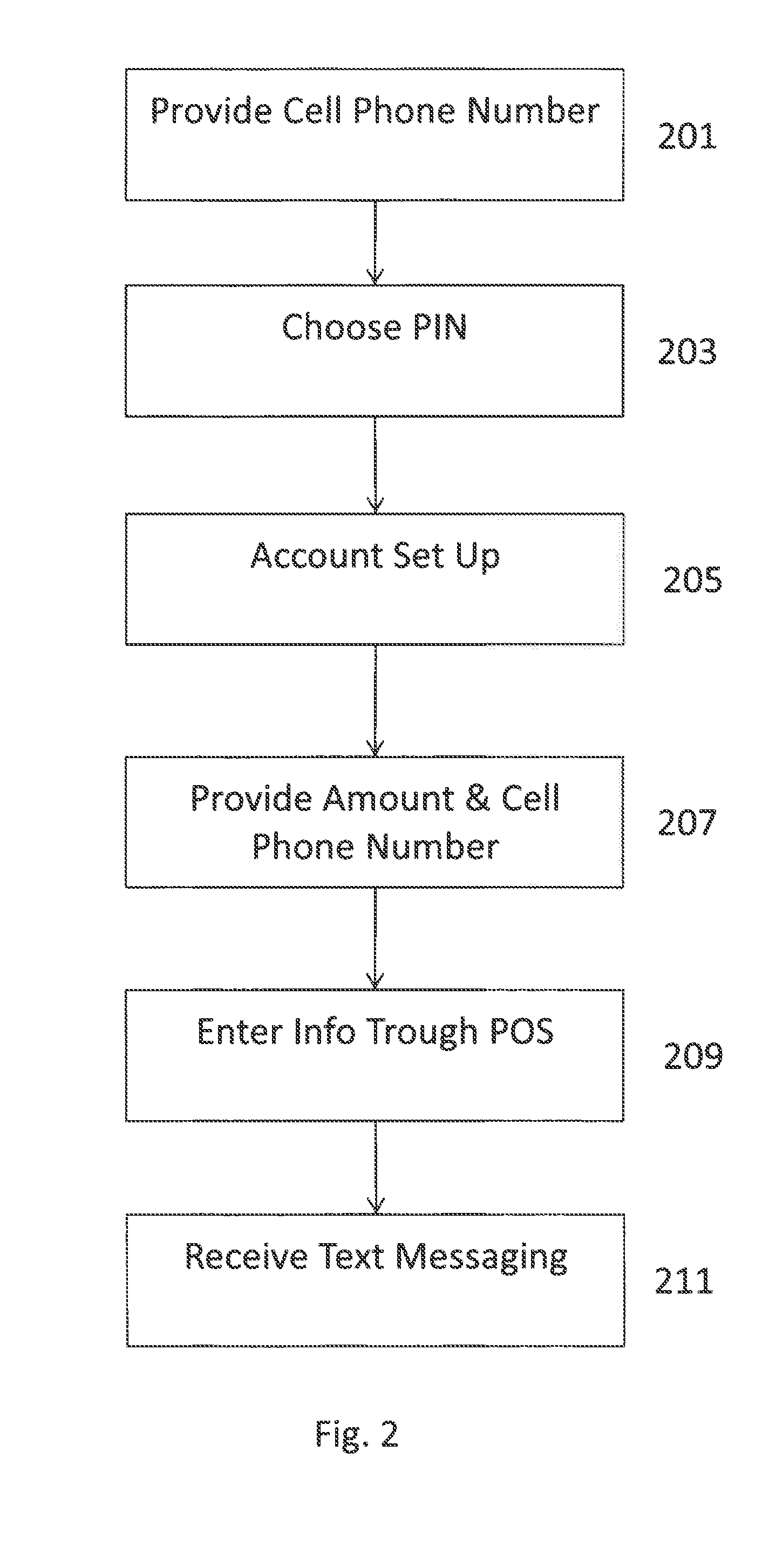

System and method for conducting financial transactions

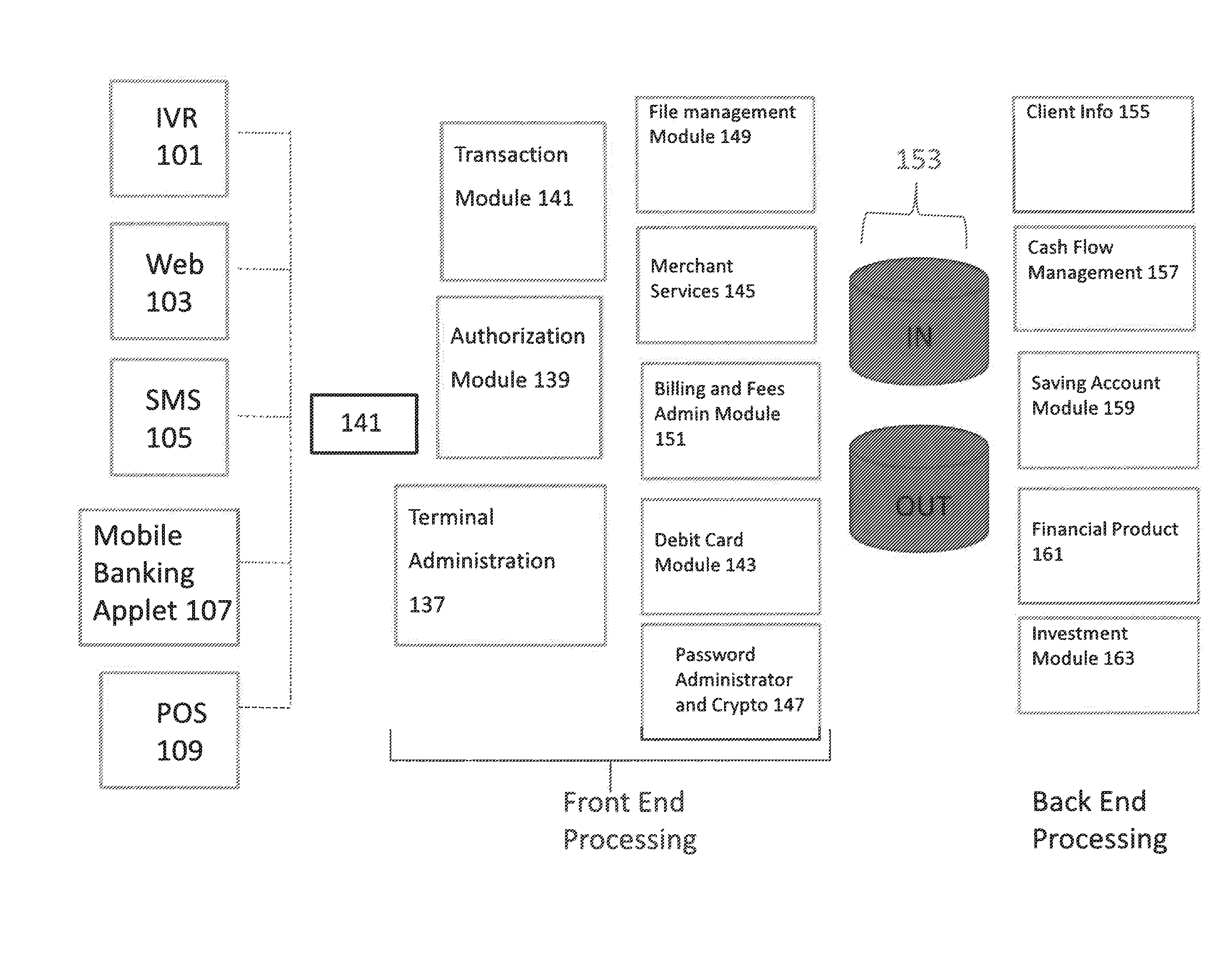

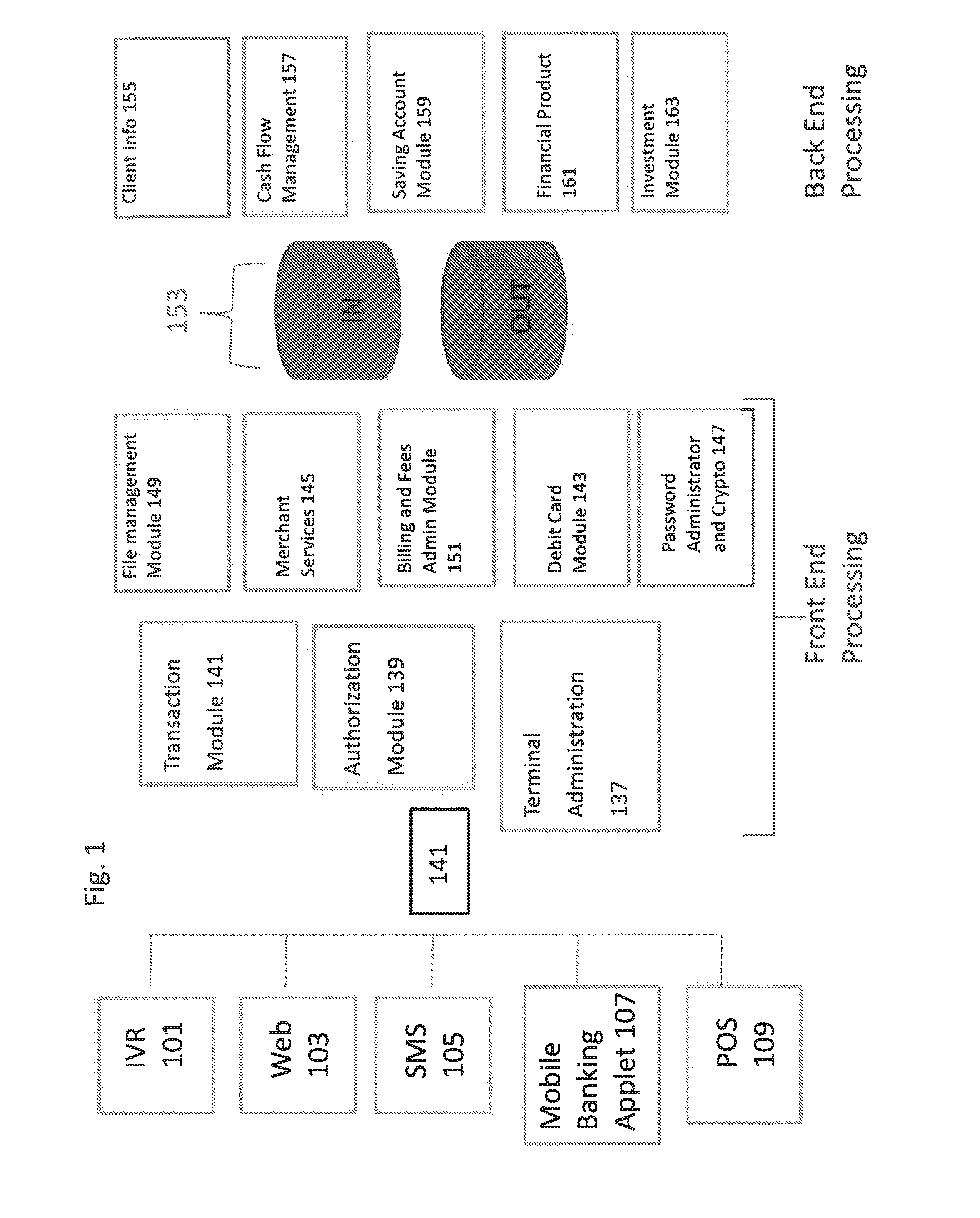

Systems and method of the present invention include a comprehensive system architecture that enables access to Non-bank financial institutions (NFBIs) and banks through point-of-sale devices and mobile telephones, for example. The present invention involves use of a modified ISO 8583 standard to allow users to interface with a front end processing system directly from non-traditional devices. The present invention also allows mobile banking with the NBFI through use of an application residing in a user's mobile telephone, which allows the encapsulation of user information as XML, for example, and the transmission of those over http while complying with the ISO 8583 standard, and further allowing encryption of certain user data, without having to resort to access to mobile banking website. In one aspect of the invention, a POS application may run on top of PCI to enable users to make purchases using funds pre-deposited in an NBFI account.

Owner:PLATAMOVIL INT

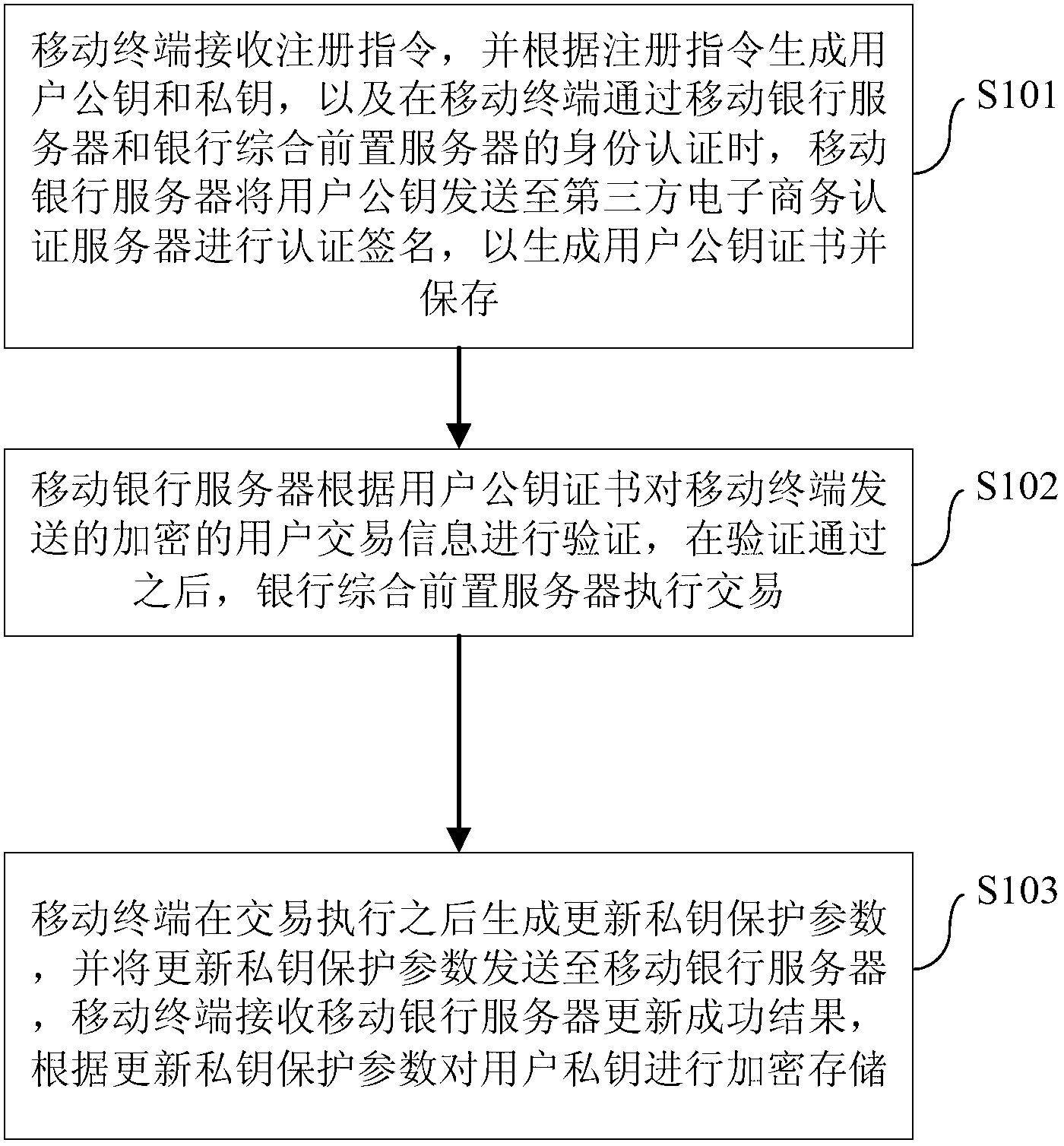

Method and system for key protection

ActiveCN103067401AAvoid interactionEnsure safetyKey distribution for secure communicationFinanceThird partyE-commerce

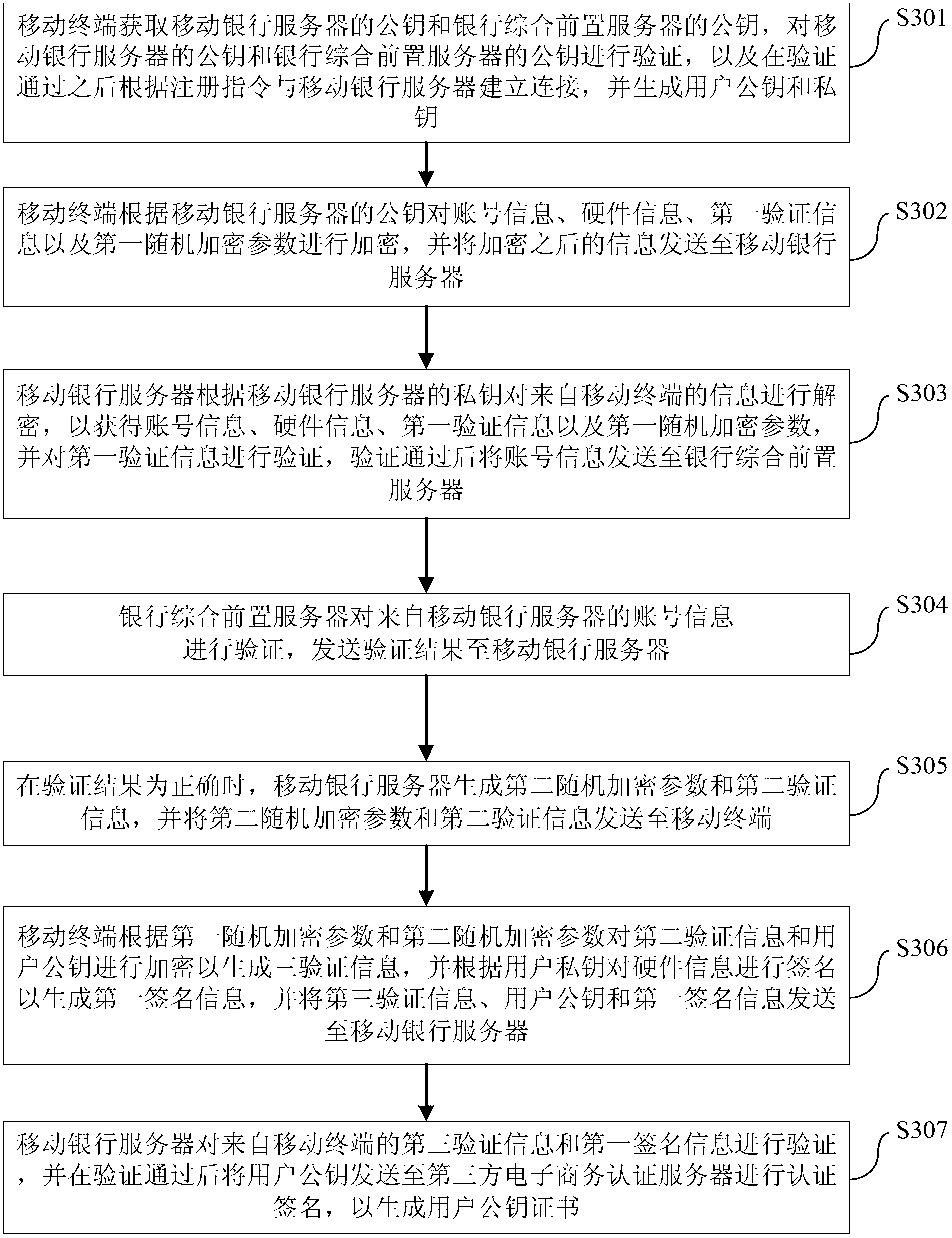

The invention provides a method for key protection and a system for the key protection. The method for the key protection includes that a mobile terminal receives a registration instruction and generates a user public key and a user private key according to the registration instruction; when the mobile terminal is subjected to identification authentication by a mobile banking server and a bank comprehensive front server, the mobile banking server sends the user public key to a third-party e-commerce authentication server for certified signing so as to generate a user public key certificate and store the user public key certificate; the mobile banking server carries out an authentication process to encrypted user transaction information sent by the mobile terminal according to the user public key certificate, and when the authentication is passed, the bank comprehensive front server executes a transaction; and after the transaction is finished, the mobile terminal generates an updated private key protecting parameter and sends the updated private key protecting parameter to the mobile banking server, and then the mobile terminal receives an update success result from the mobile banking server and encrypts and stores the user private key according to the updated private key protecting parameter. The method for the key protection and the system for the key protection can increase attack difficulty and improve safety.

Owner:TENDYRON CORP

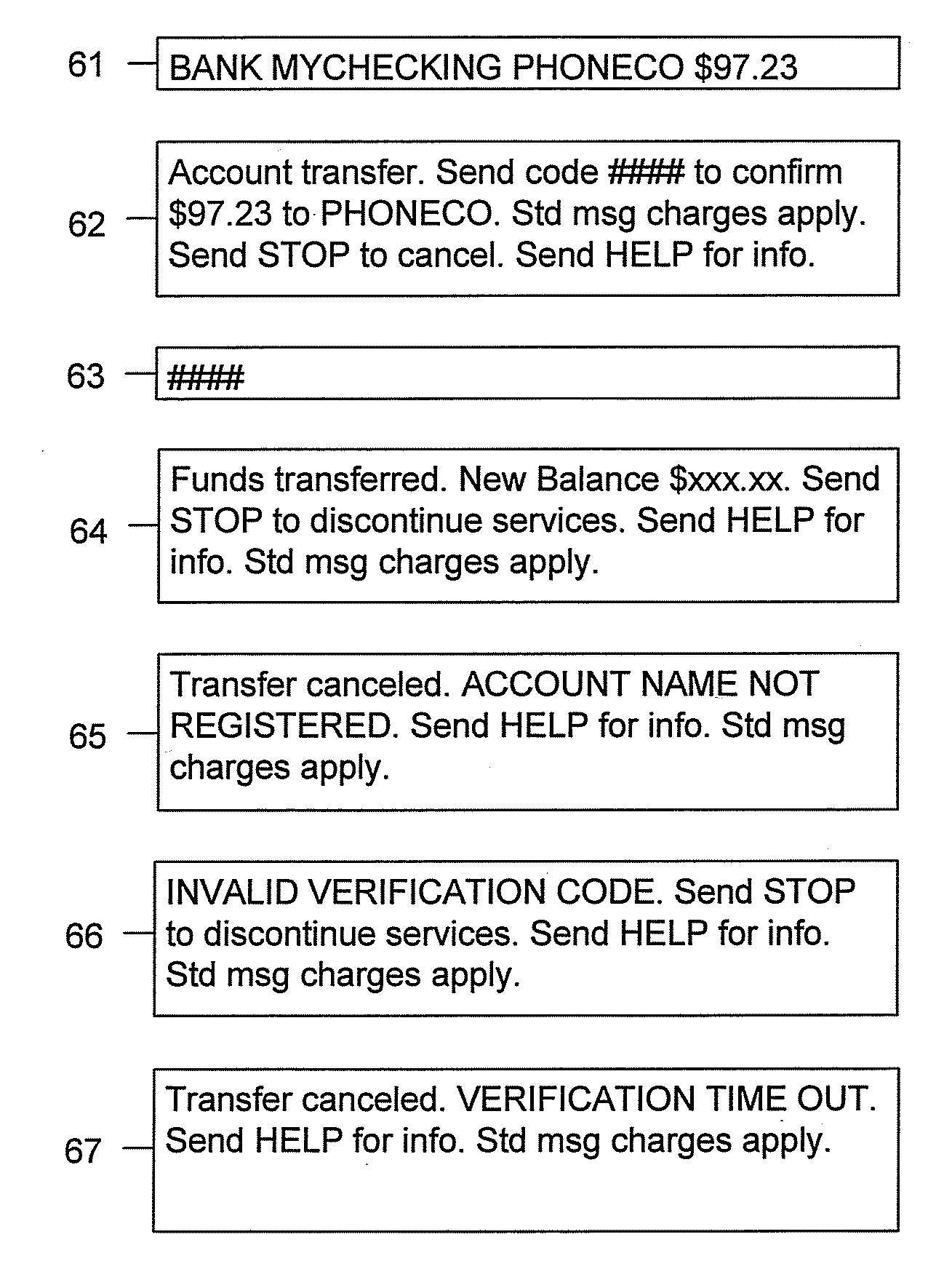

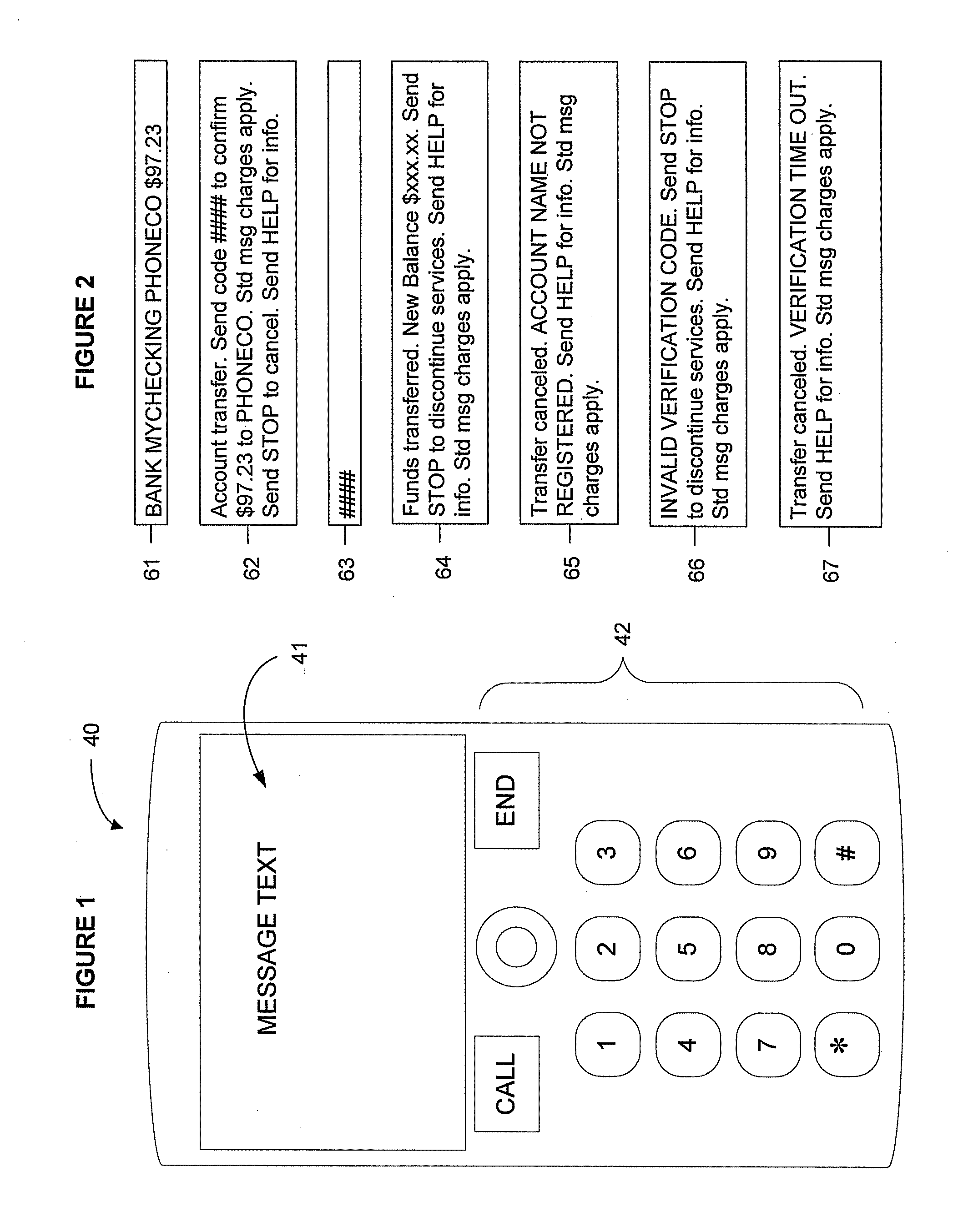

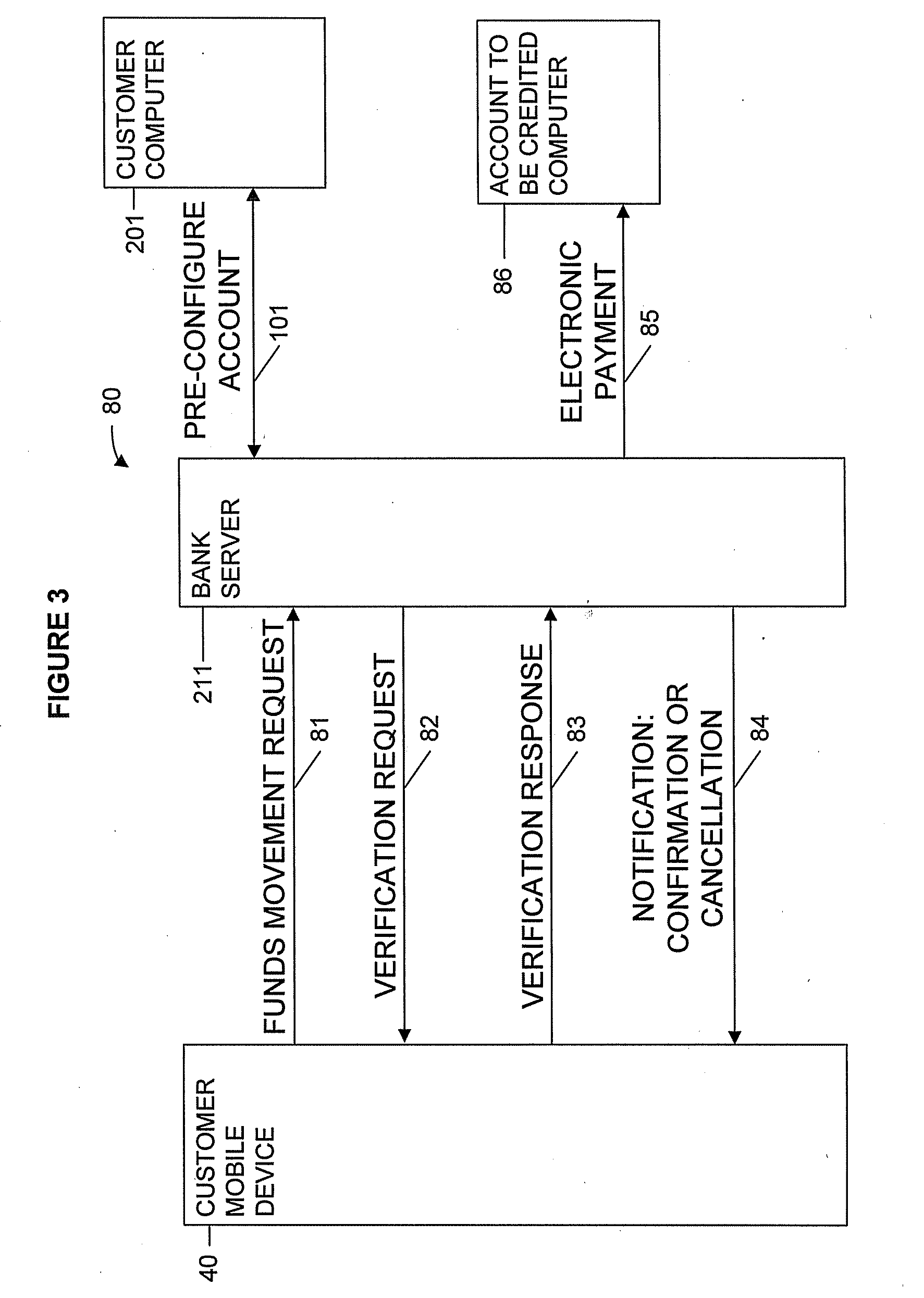

Machine, program product, and computer-implemented methods for confirming a mobile banking request

InactiveUS20110060684A1Improve securityFinancePayment architectureShort Message ServiceNetwork Communication Protocols

Embodiments of the present invention include methods, program product and machines for providing a confirmation for a mobile banking request, e.g., a funds movement request, originating via a text message utilizing a predetermined communications protocol, e.g., Short Message Service (SMS). A customer sends and a bank server receives a request originating via text message. The text message can include an amount and identifiers for accounts to be debited and credited. The bank server accesses an account responsive to a phone number associated with the text message. The bank server stores the request as pending. The bank server sends a verification request via text message to the customer and then receives a verification response via text message from the customer. The verification request can include a one-time verification code required for a valid verification response. Next, the bank server authorizes the pending request responsive to a valid verification response.

Owner:JUCHT SCOTT J +1

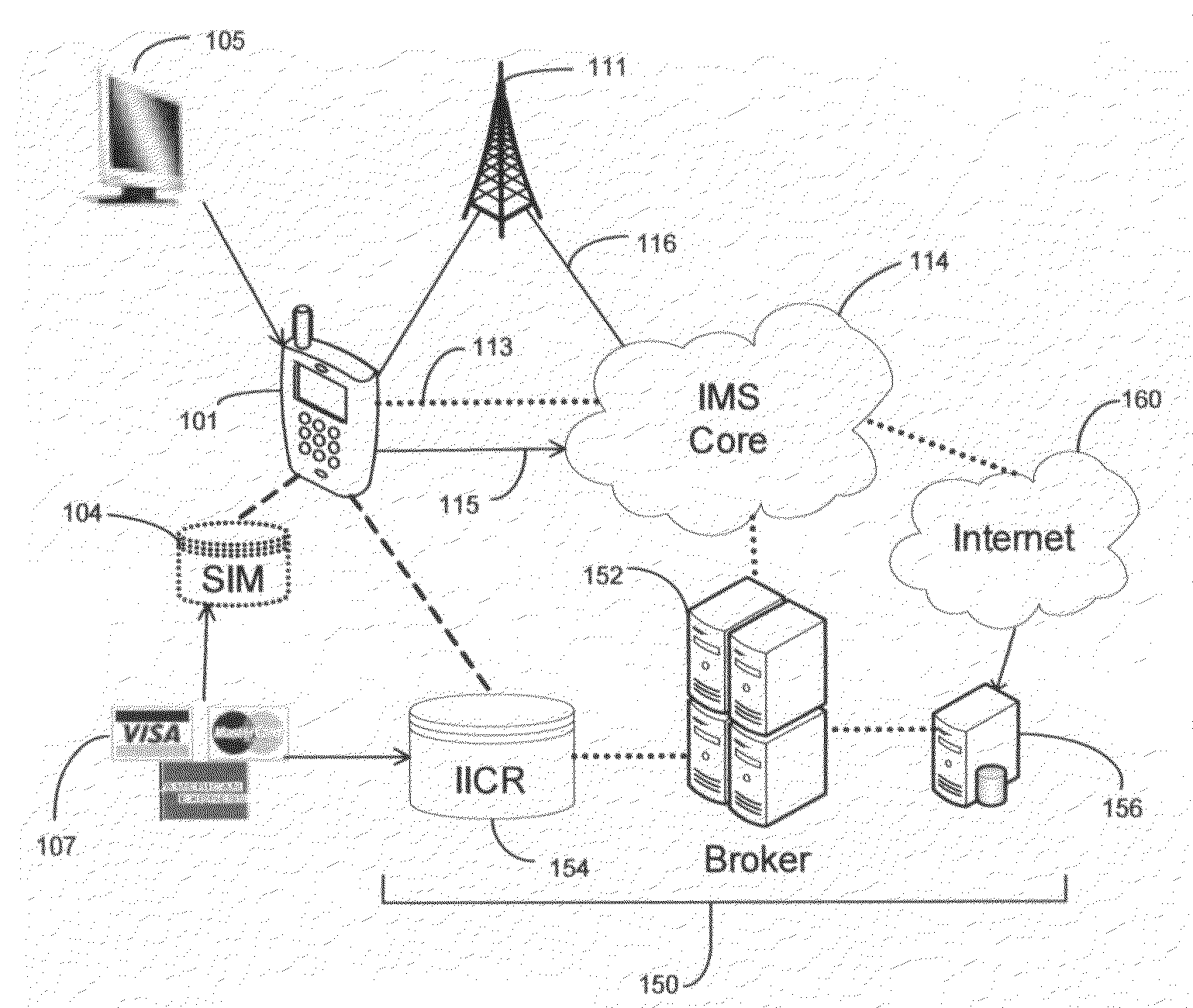

Systems and methods for profile-based mobile commerce

ActiveUS8611867B2Minimize lagConvenient lifeFinanceSpecial service for subscribersSystems analysisFinancial transaction

The invention discloses systems and methods for integrating Mobile Commerce applications with dynamically generated user profiles. A profiling engine collects and stores information regarding a mobile subscriber's usage of Mobile Banking, Mobile Payment, and Mobile Brokerage, and stores the information in a profile. A Dynamic Event Server Subsystem comprising a Mobile Broker analyzes patterns in the subscriber's usage of these applications. The mobile broker can thus provide intelligent feedback regarding purchases and financial transactions back to the applications and to the subscriber. This feedback is provided in real time.

Owner:CINGULAR WIRELESS II LLC

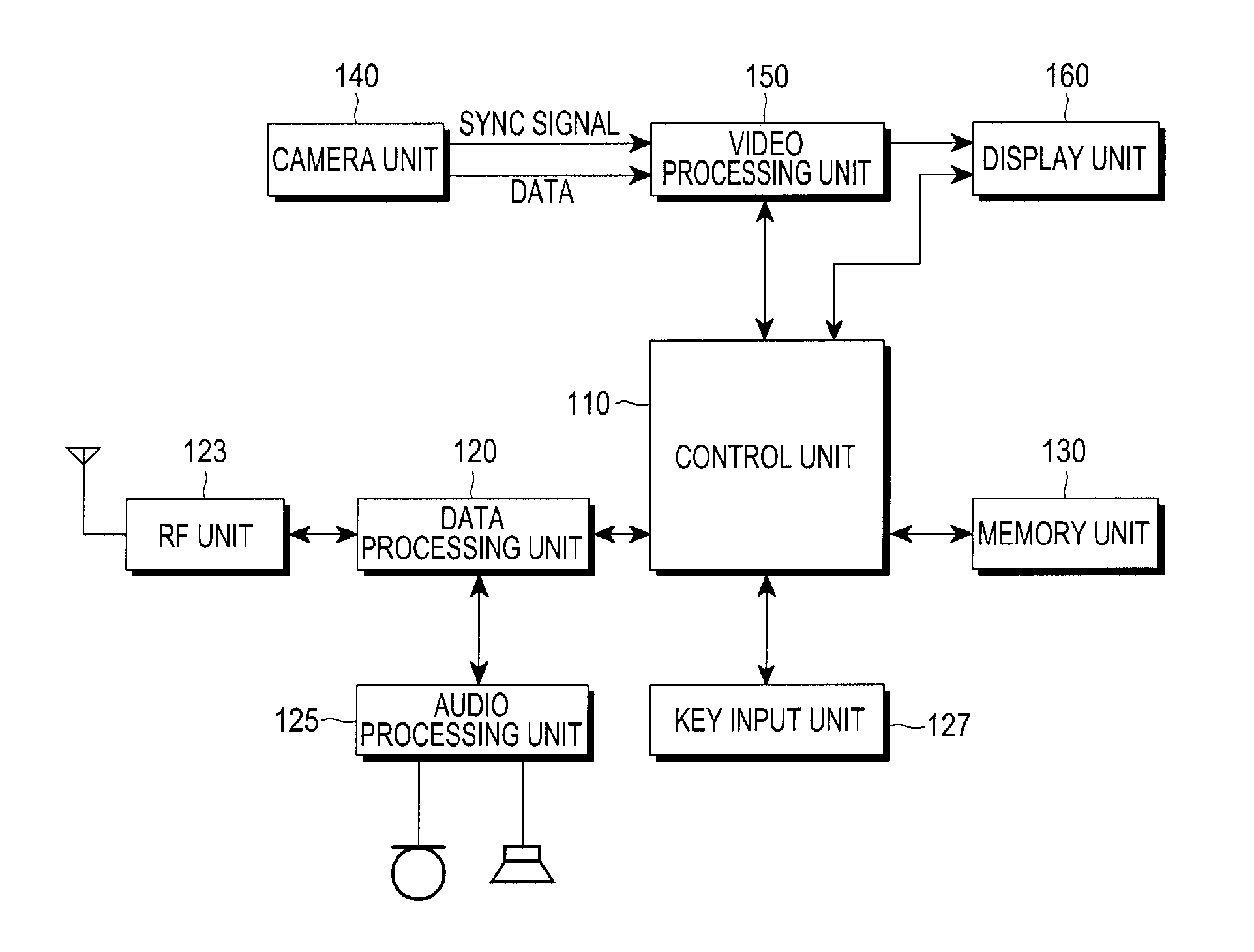

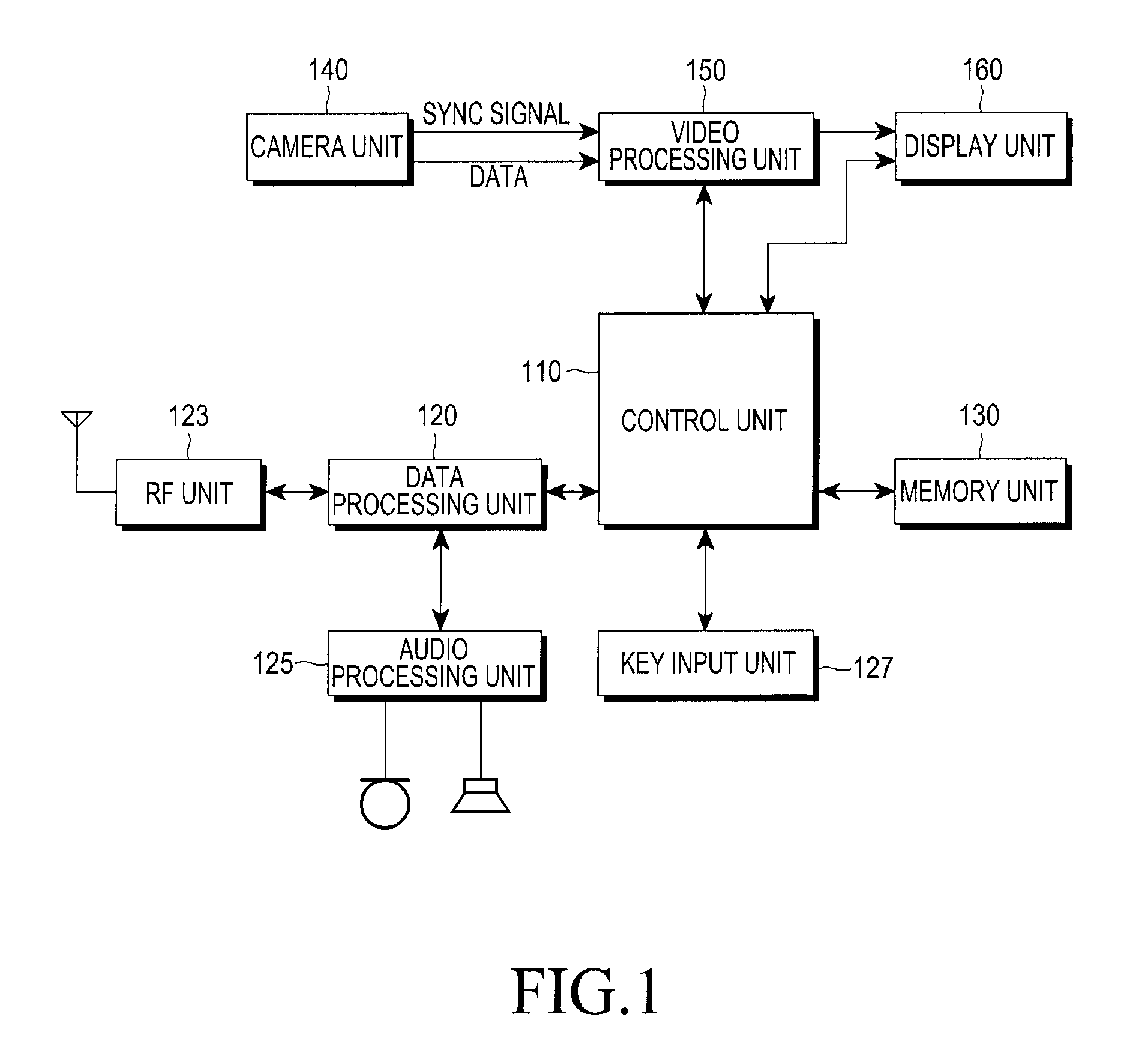

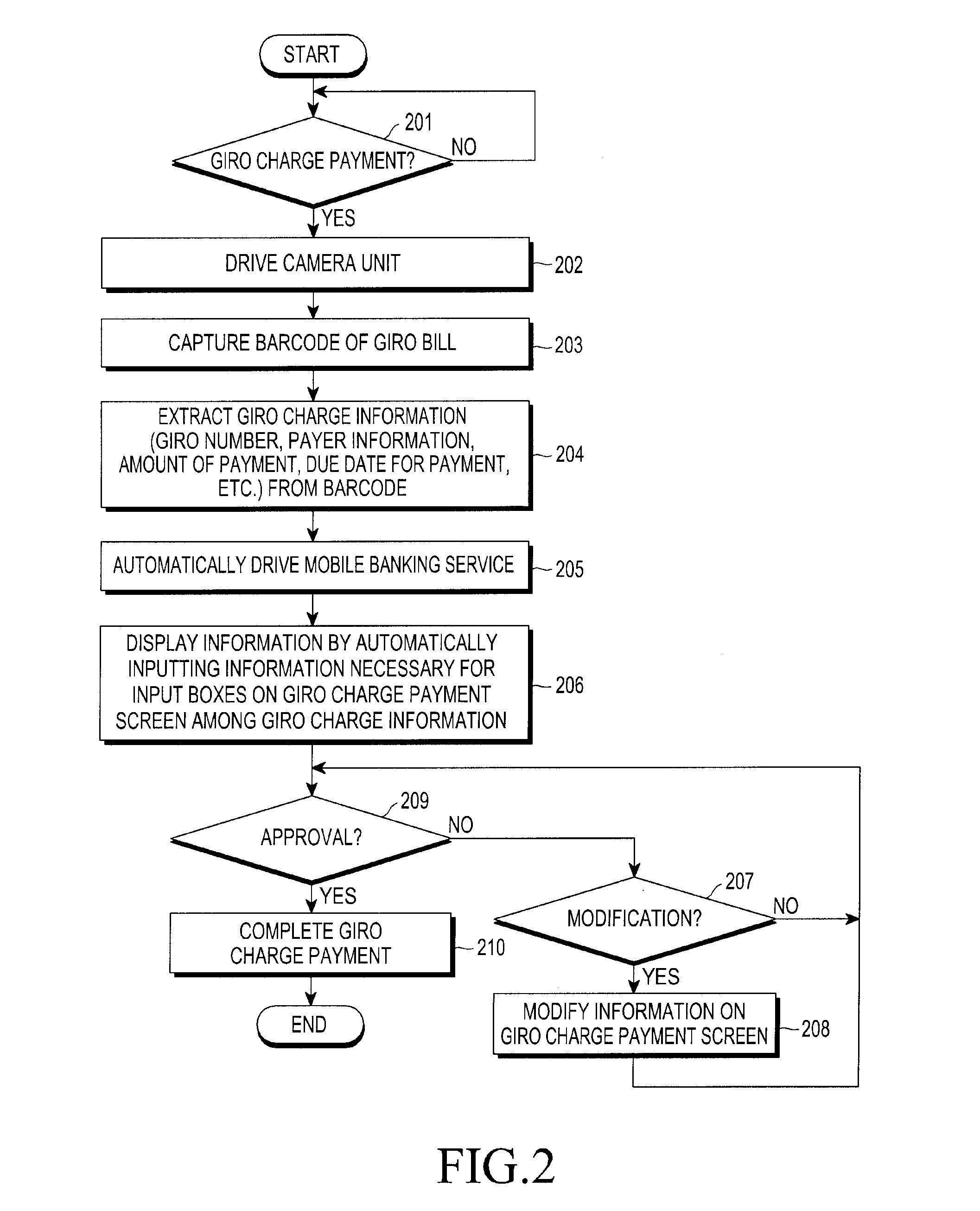

Apparatus and method for giro charge payment in portable terminal

An apparatus and method for giro charge payment in a portable terminal are provided. The apparatus for giro charge payment in a portable terminal includes a camera unit and a control unit. The camera unit captures a barcode of a giro bill. The control unit extracts giro charge information from the barcode captured by the camera unit in a giro payment mode, and pays a giro charge by automatically inputting the extracted giro charge information on a giro charge payment screen of a mobile banking service.

Owner:SAMSUNG ELECTRONICS CO LTD

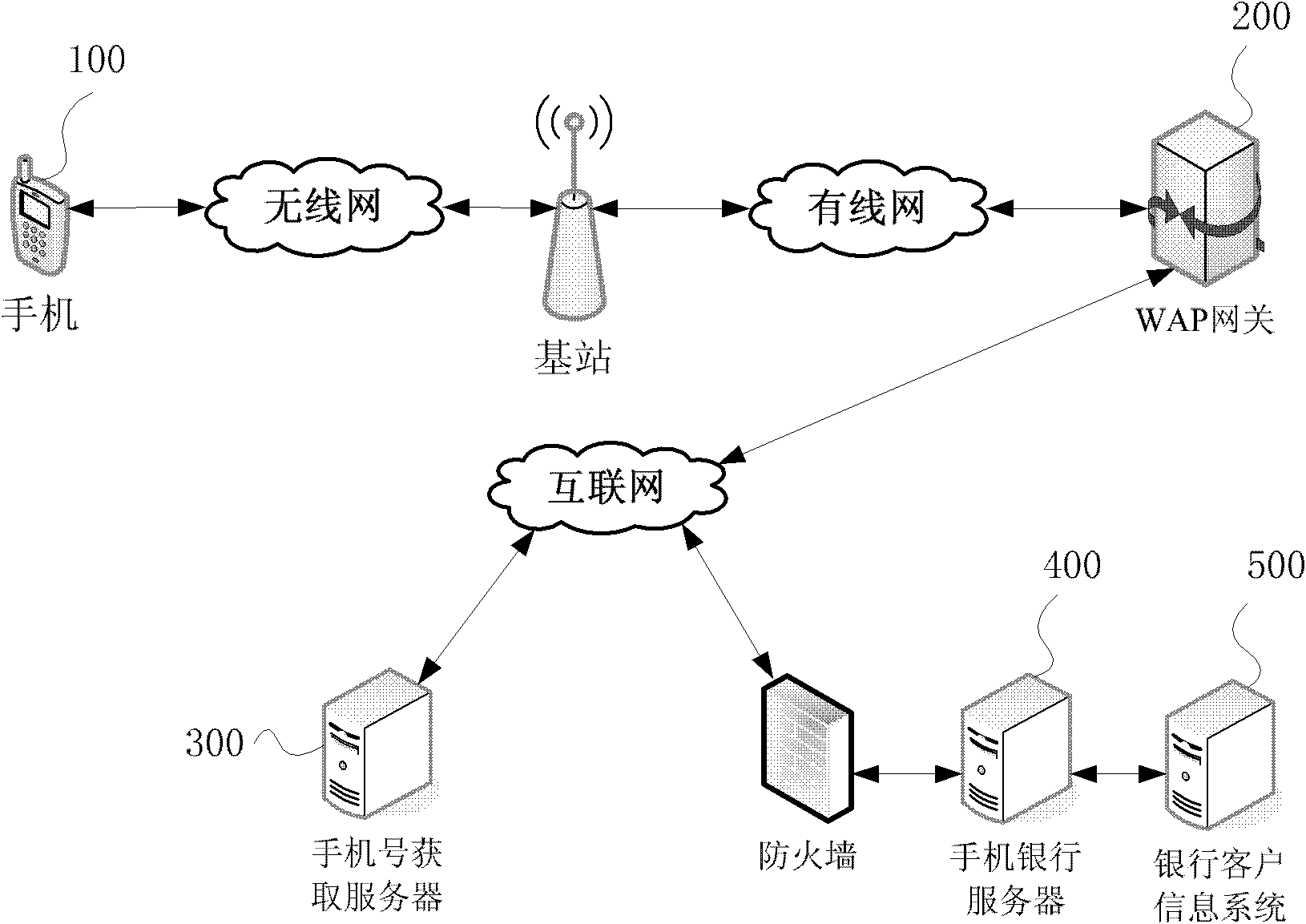

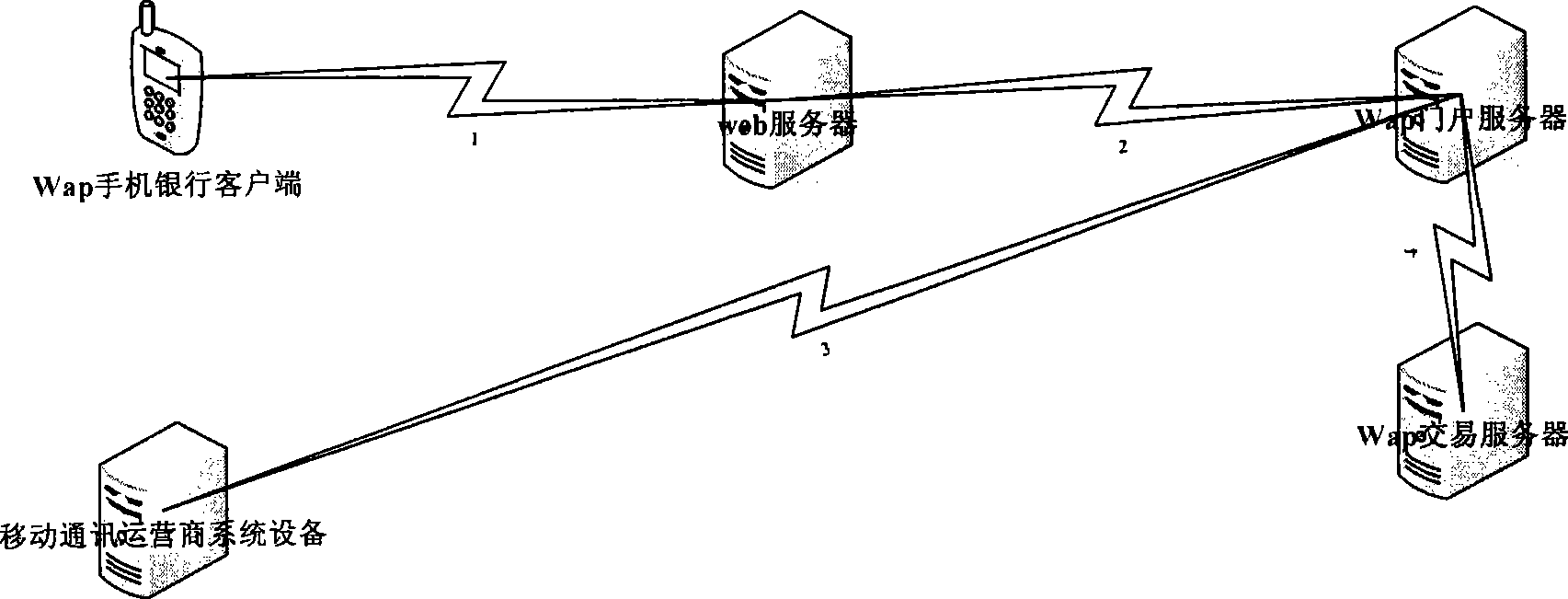

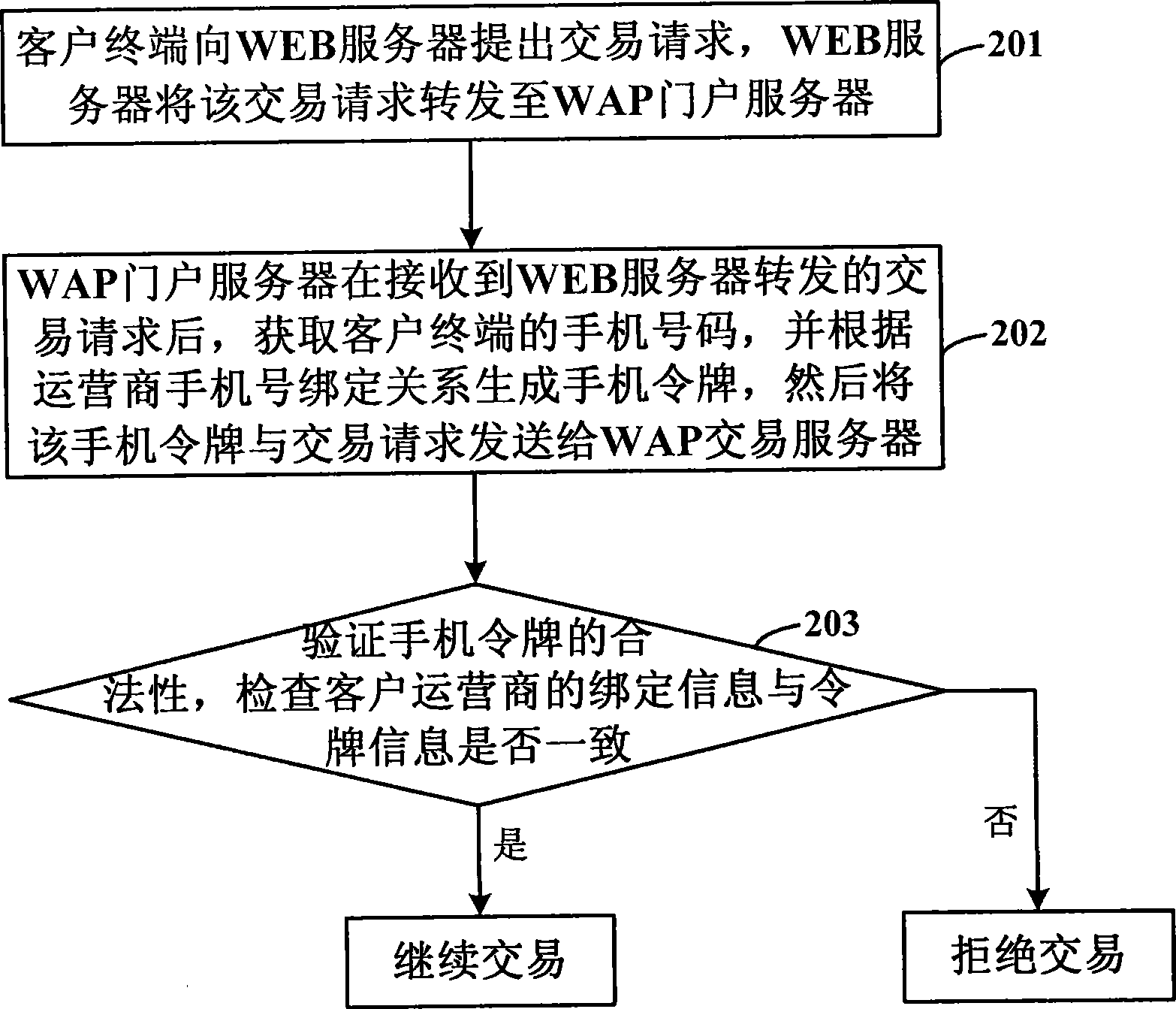

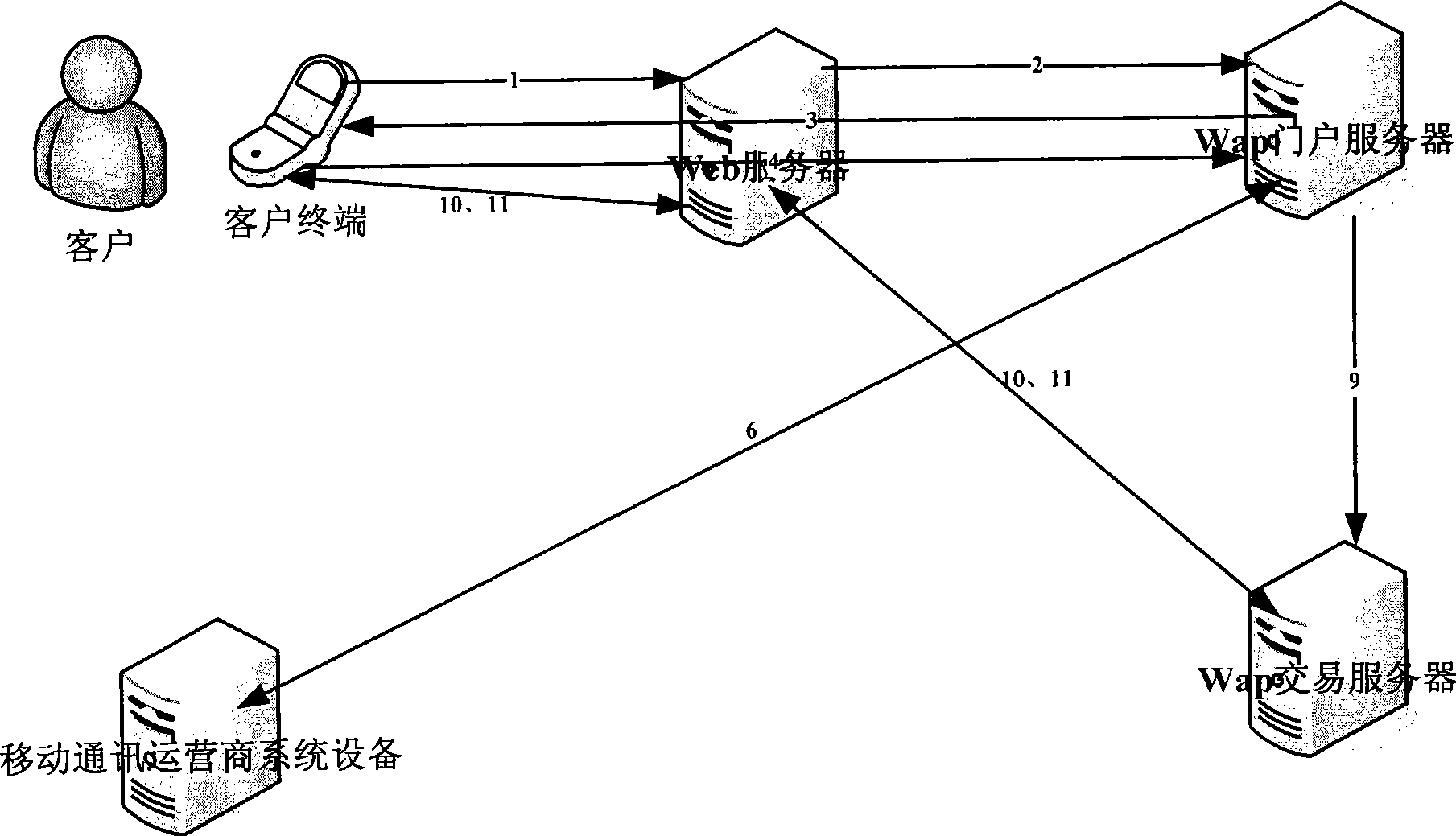

System for realizing WAP mobile banking transaction security control and method thereof

ActiveCN101448001AImprove securityAvoid visitingPayment architectureTransmissionDomain nameMobile Telephone Number

The invention discloses a system for realizing WAP mobile banking transaction security control and a method thereof. The system comprises a user terminal, a WEB server, a WAP portal server, a WAP transaction server and mobile communication operator system equipment, wherein, the WEB server is used for providing domain name address service and transferring a transaction request received from the user terminal to the WAP portal server; the WAP portal server is used for acquiring the mobile phone number of the user terminal, generating a mobile token according to operator mobile phone binding relations and sending the mobile token and the transaction request to the WAP transaction server; the WAP transaction server is used for verifying validity of the mobile token and checking whether user operator binding information is consistent with token information; the mobile communication operator system equipment is used for providing an interface to the WAP portal server and the WAP portal server acquires the mobile phone number by communicating with the mobile communication operator system equipment. By adopting the invention, the user can be prevented from visiting the WAP mobile banking by the internet, thereby effectively improving security of visiting the mobile banking.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

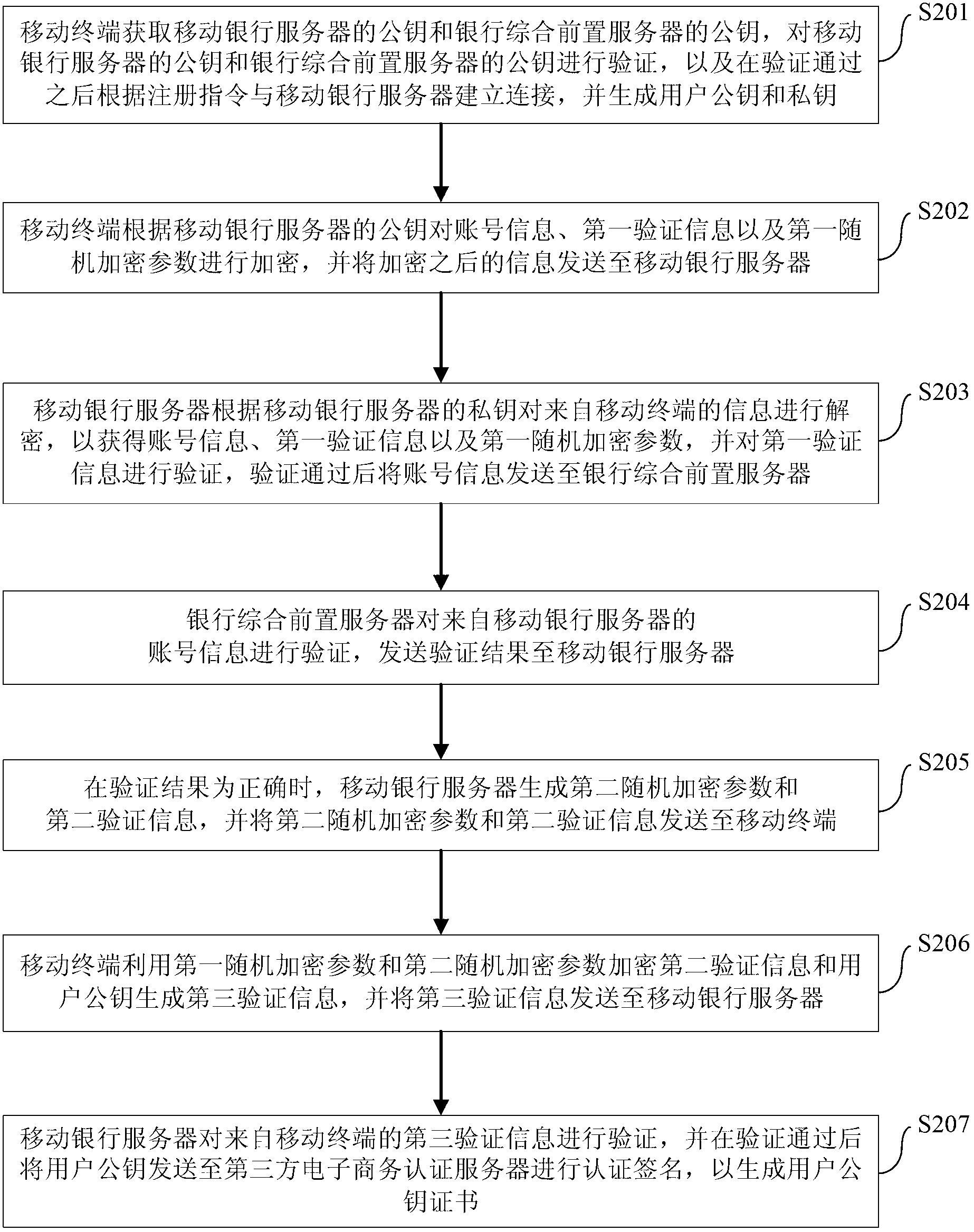

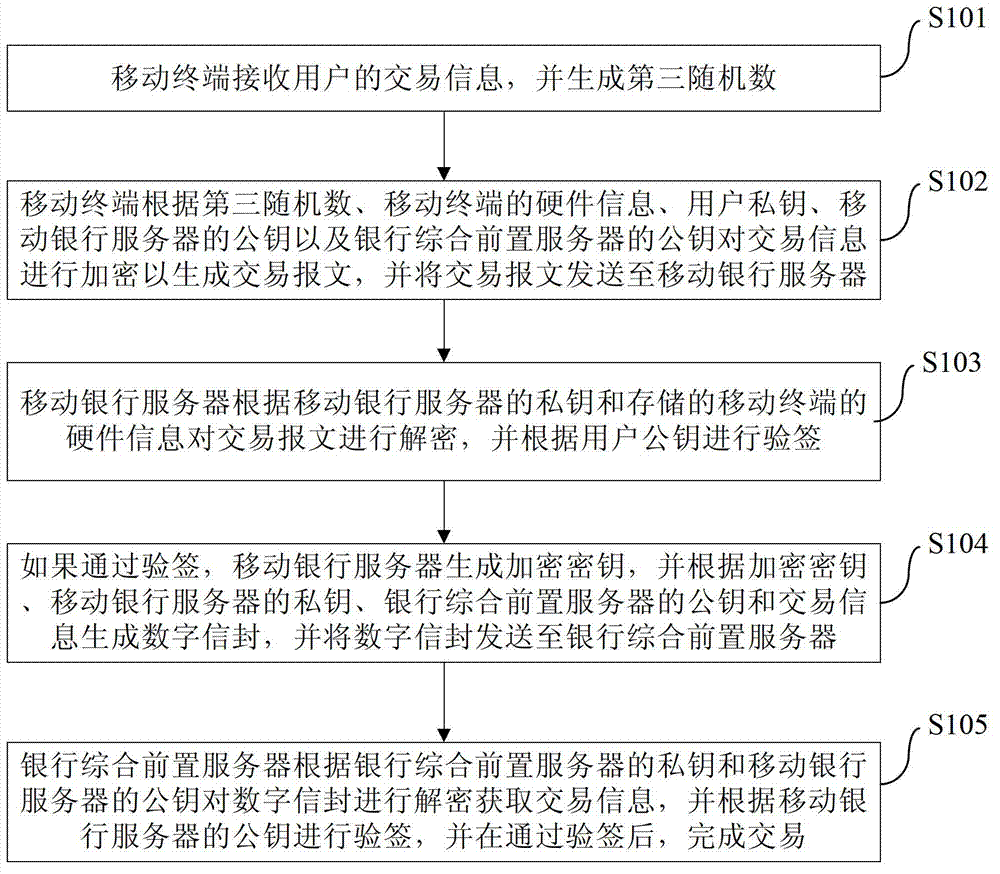

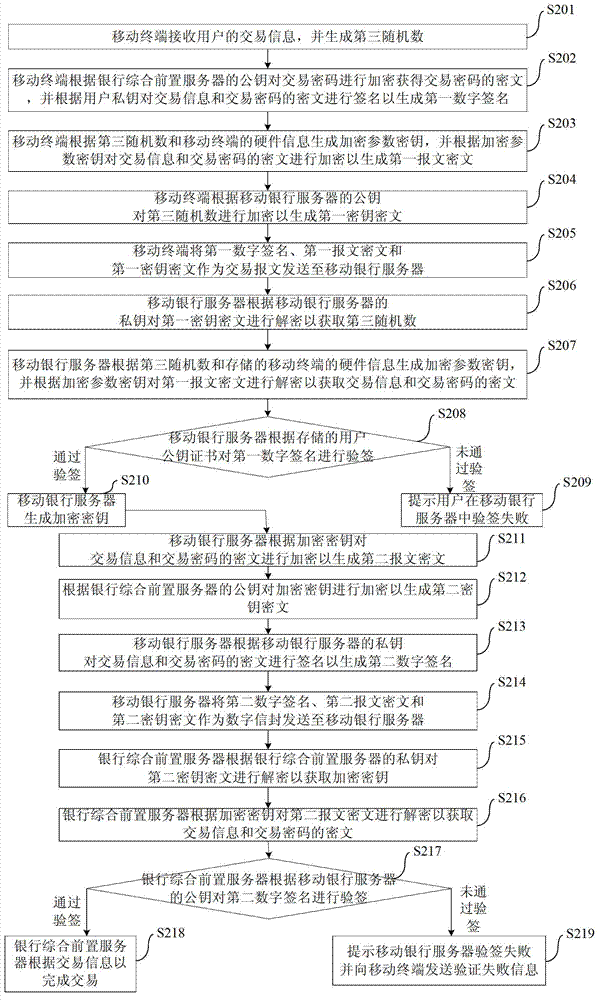

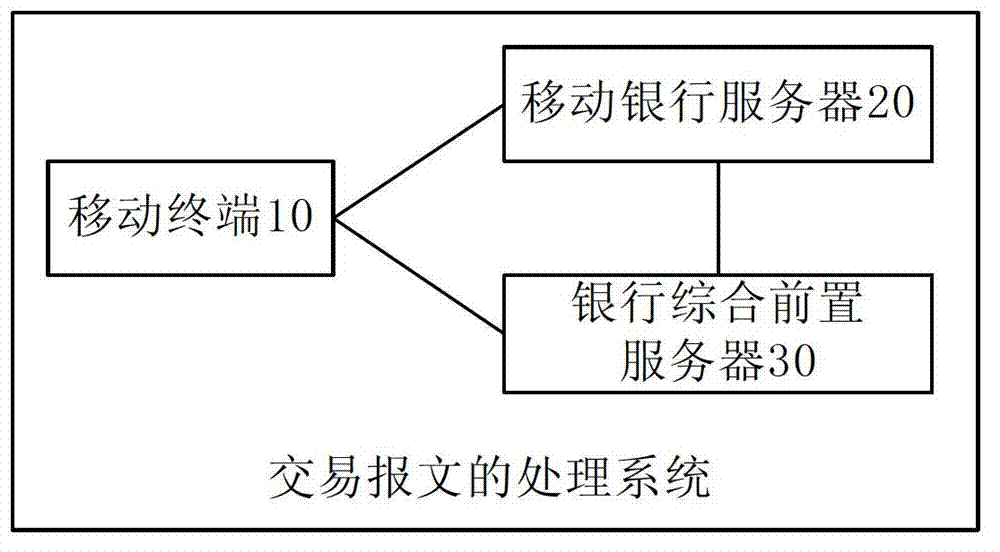

Method and system for processing transaction messages

ActiveCN103095456AEnsure safetyGuaranteed safe transmissionPublic key for secure communicationUser identity/authority verificationSecure transmissionMobile payment

The invention provides a method and a system for processing transaction messages. The method comprises the following steps: a mobile terminal receives transaction information, and encrypts the transaction information according to a random number, hardware information, a user private key and a public key of a mobile bank server so as to obtain transaction messages and send the messages to the mobile bank server. The mobile bank server deciphers the transaction messages and verifies and signs for the messages according to the public key of the user. After verification and signature, an encryption key is generated, a digital envelope is generated according to the encryption key, the private key of the mobile bank server, a public key of a bank comprehensive prepositive server and the transaction information, and the digital envelope is sent to the bank comprehensive prepositive server. The bank comprehensive prepositive server deciphers the digital envelope according to the private key and the public key of the mobile bank server to obtain the transaction information and close the deal. By utilizing the method and the system, safe transmission of the transaction information among the mobile terminal, the mobile bank server and the bank comprehensive prepositive server can be ensured, and safety in mobile payment is guaranteed.

Owner:TENDYRON CORP

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com