Patents

Literature

325 results about "Internet bank" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

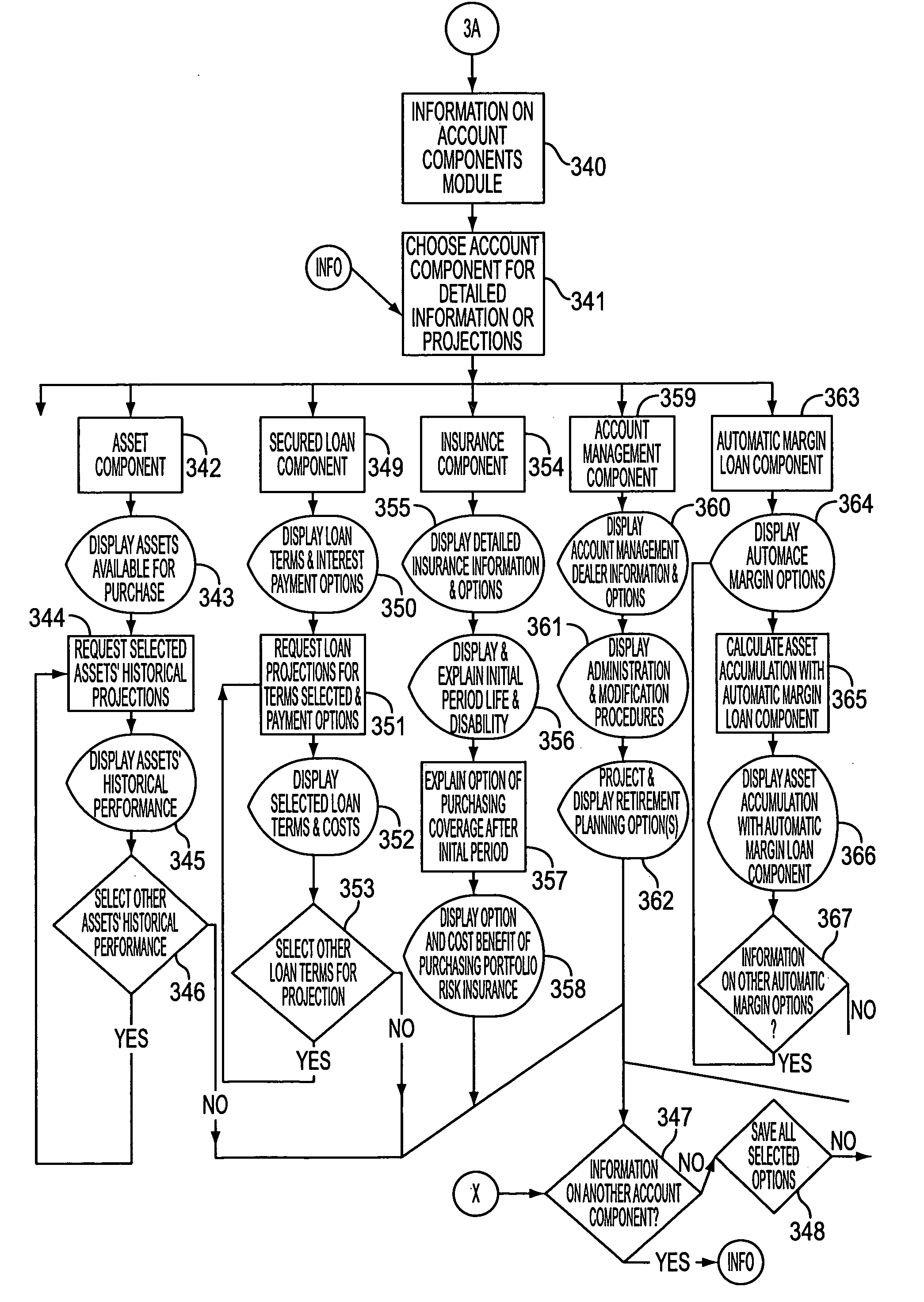

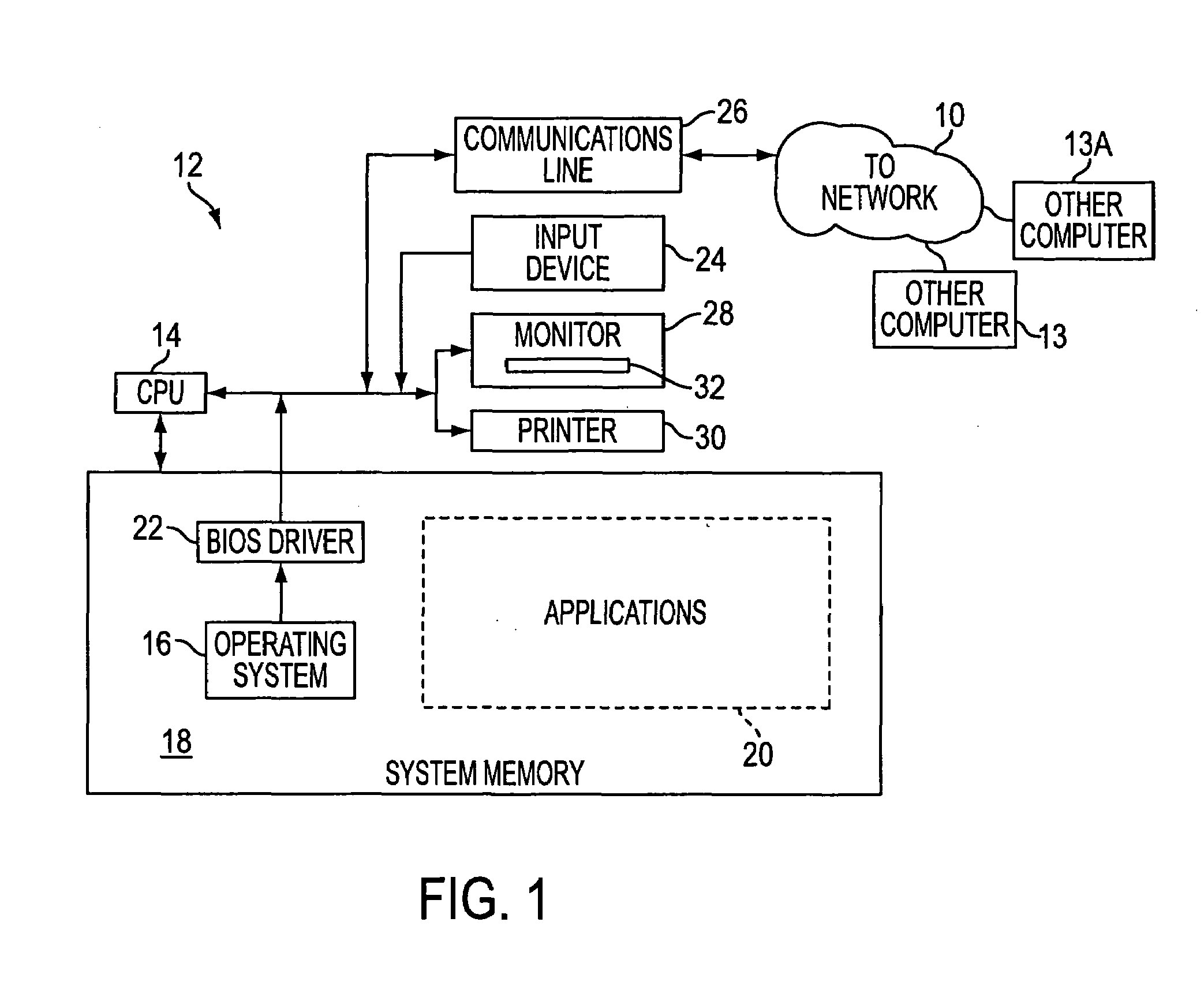

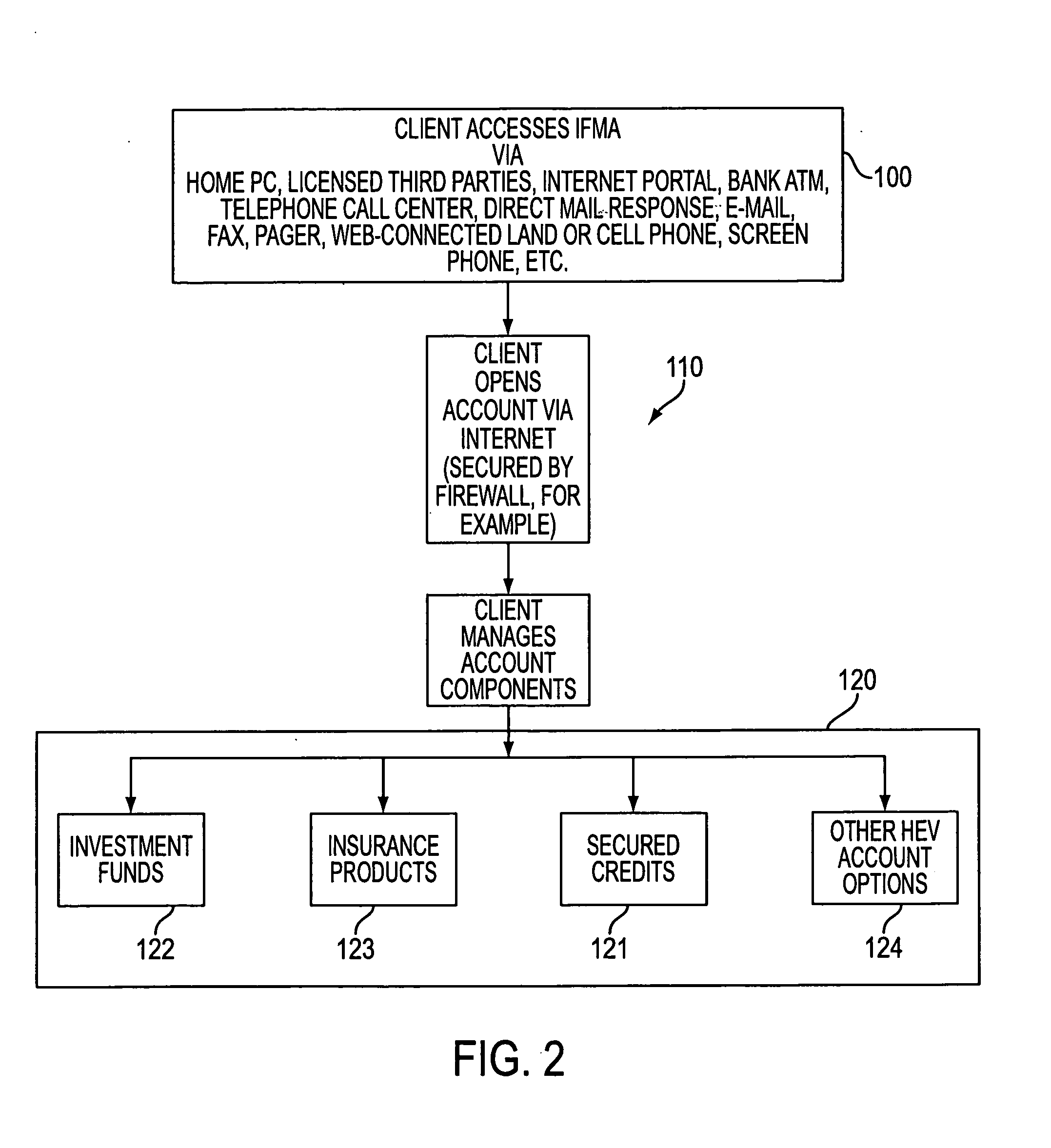

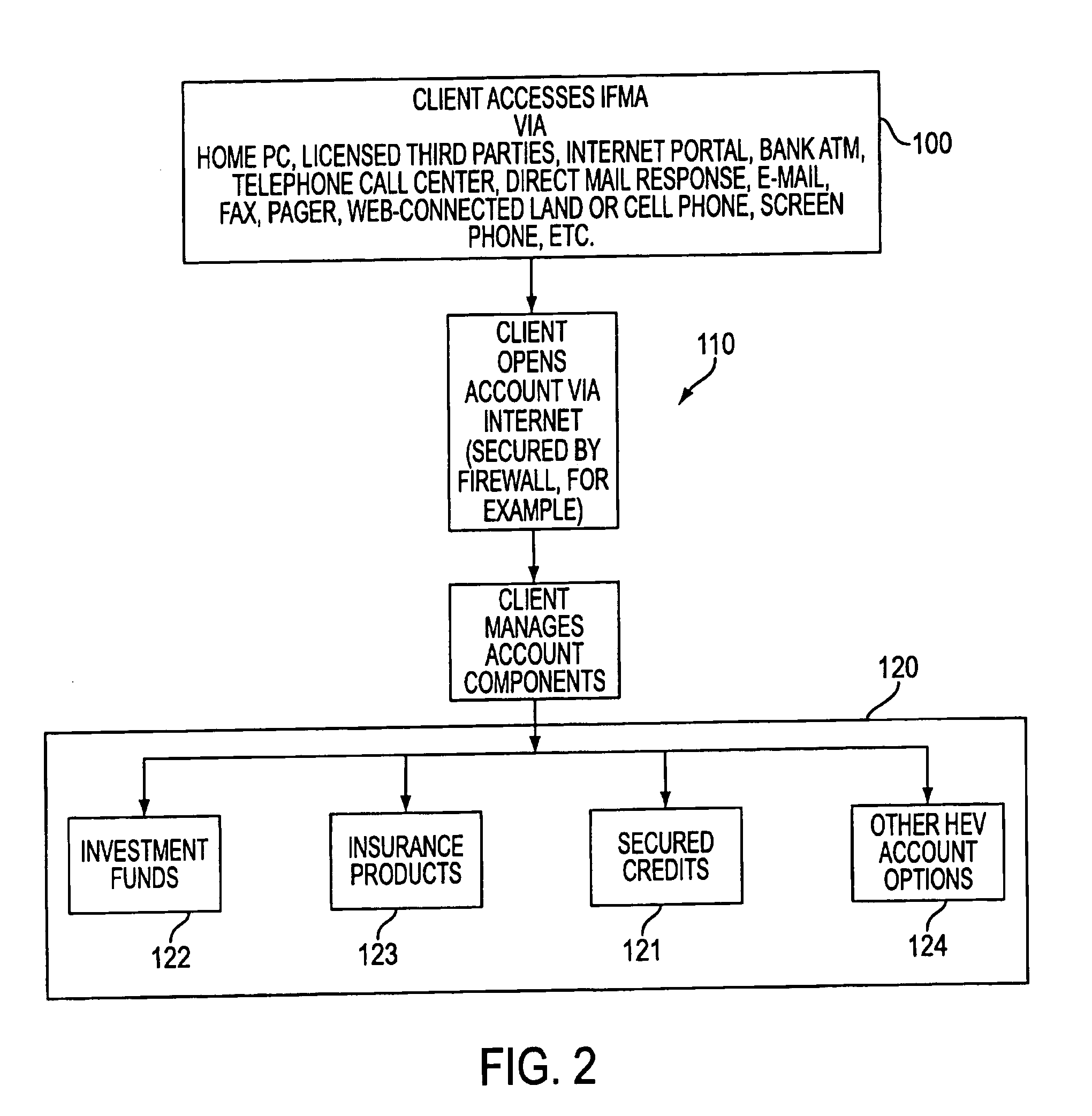

Method and system for internet banking and financial services

A computer implemented method of providing a client with an integrated financial management account, including receiving application data for an integrated financial management account and setting up the integrated financial account with a loan component data, an investment component data, and an insurance component, all associated with an account file. Thereby qualifying the client for a loan in the loan component of the integrated financial management account and associating the qualification information with the account file, disbursing the proceeds of the loan component into the investment component by recording a proceed value in the investment component data associated with the account file, and purchasing investment assets using the proceeds of the loan component and associating purchased investment assets to the investment component data associated with the account file.

Owner:NOLAND CATHLEEN

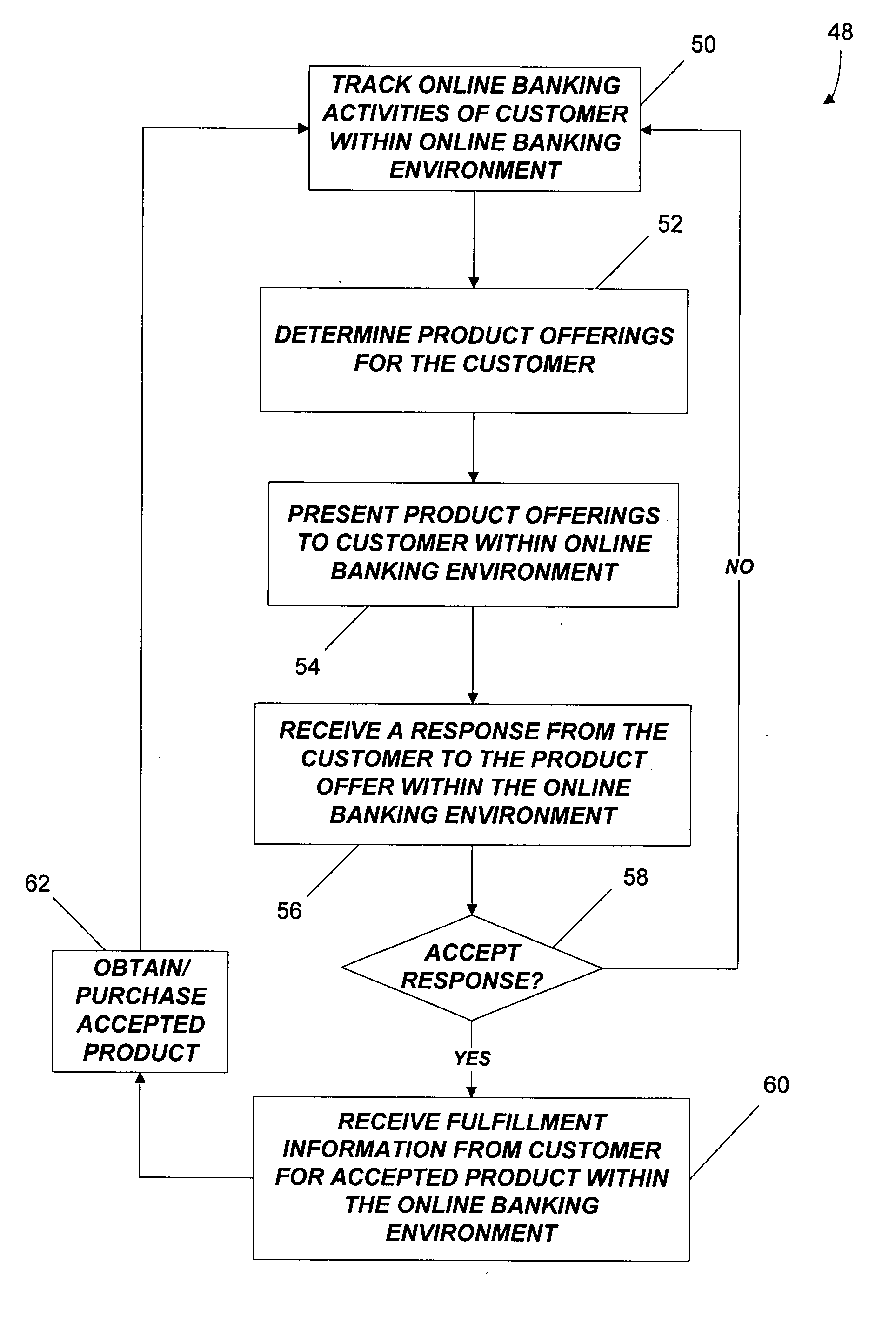

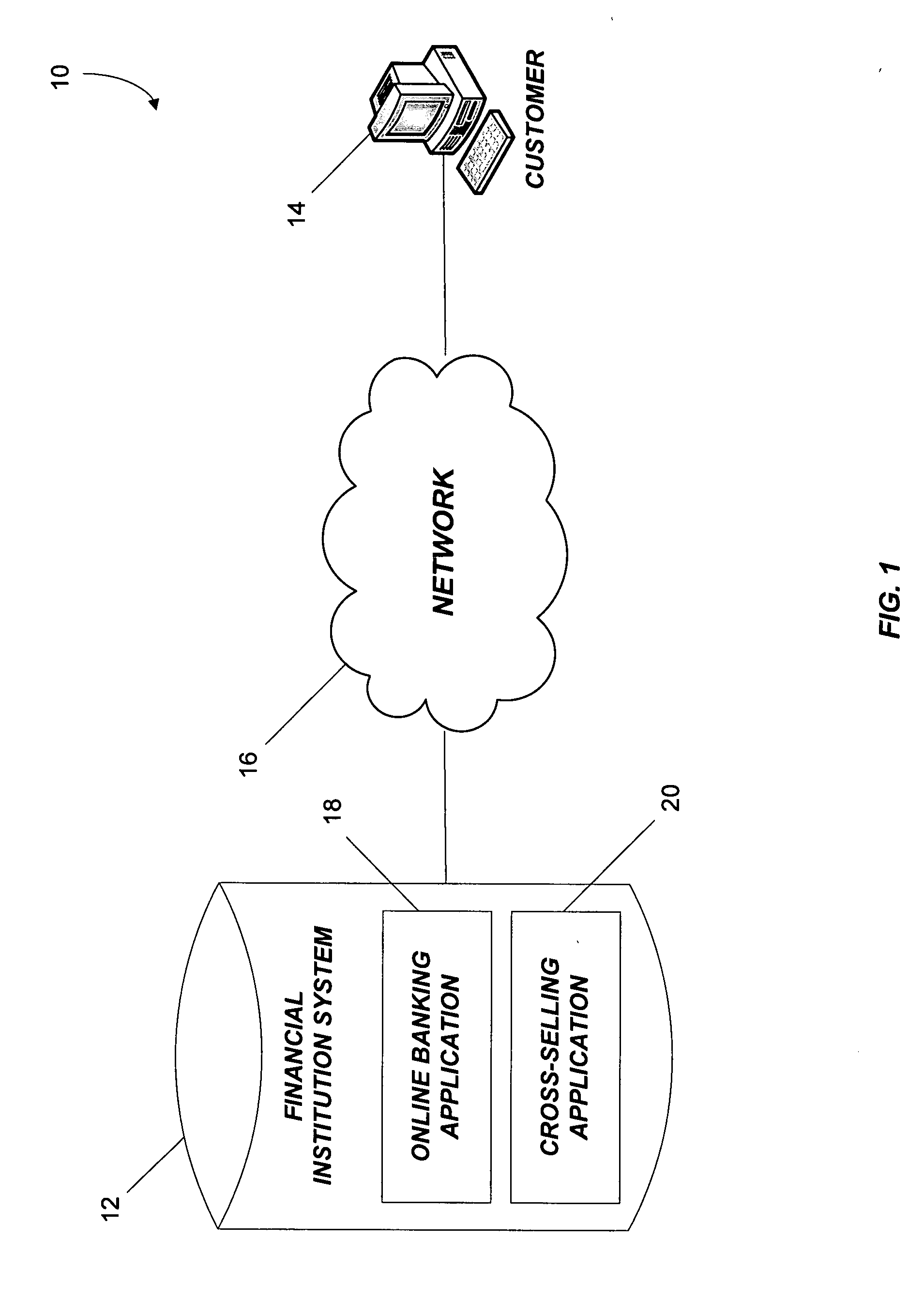

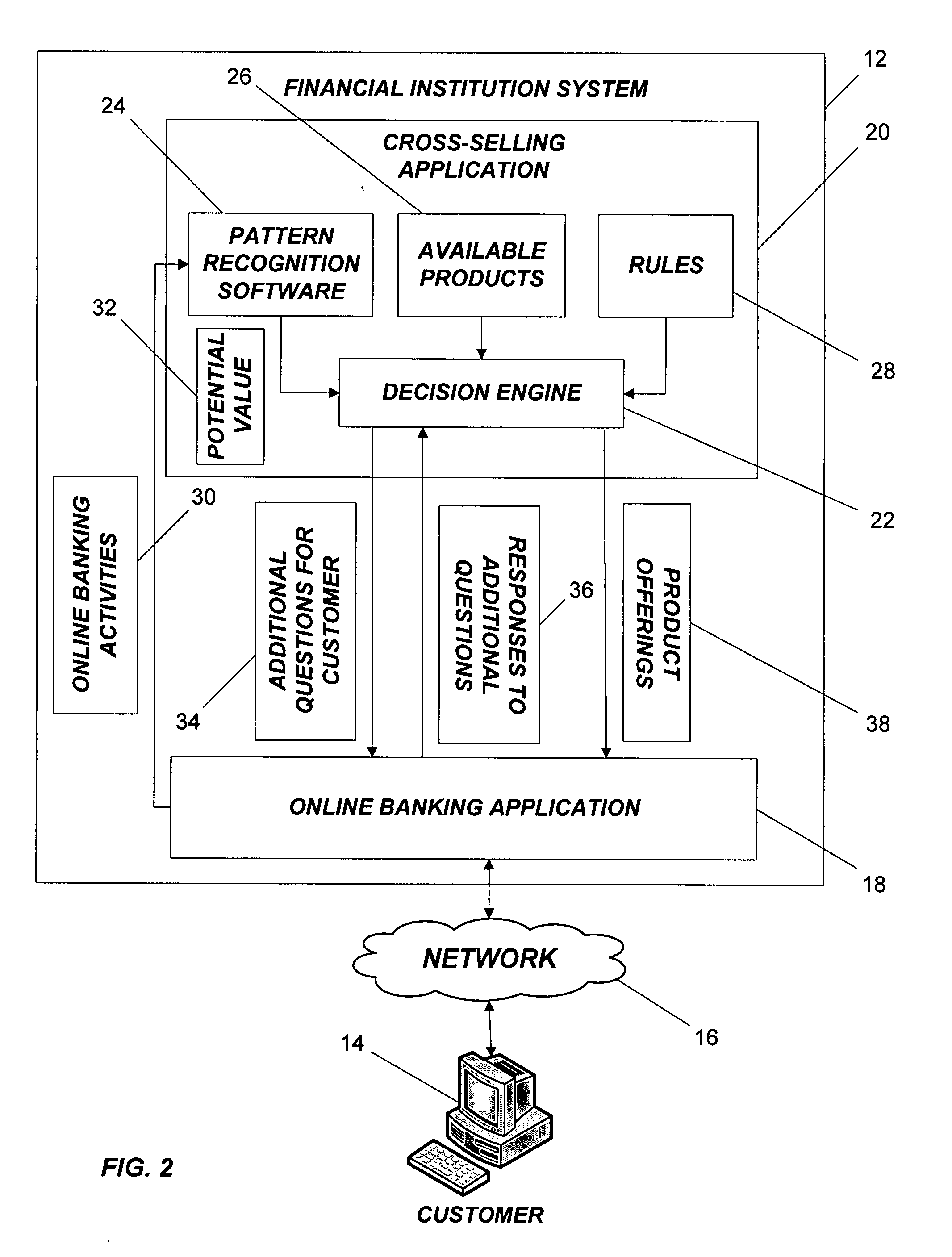

Methods and systems for providing cross-selling with online banking environments

Owner:FIDELITY INFORMATION SERVICES LLC

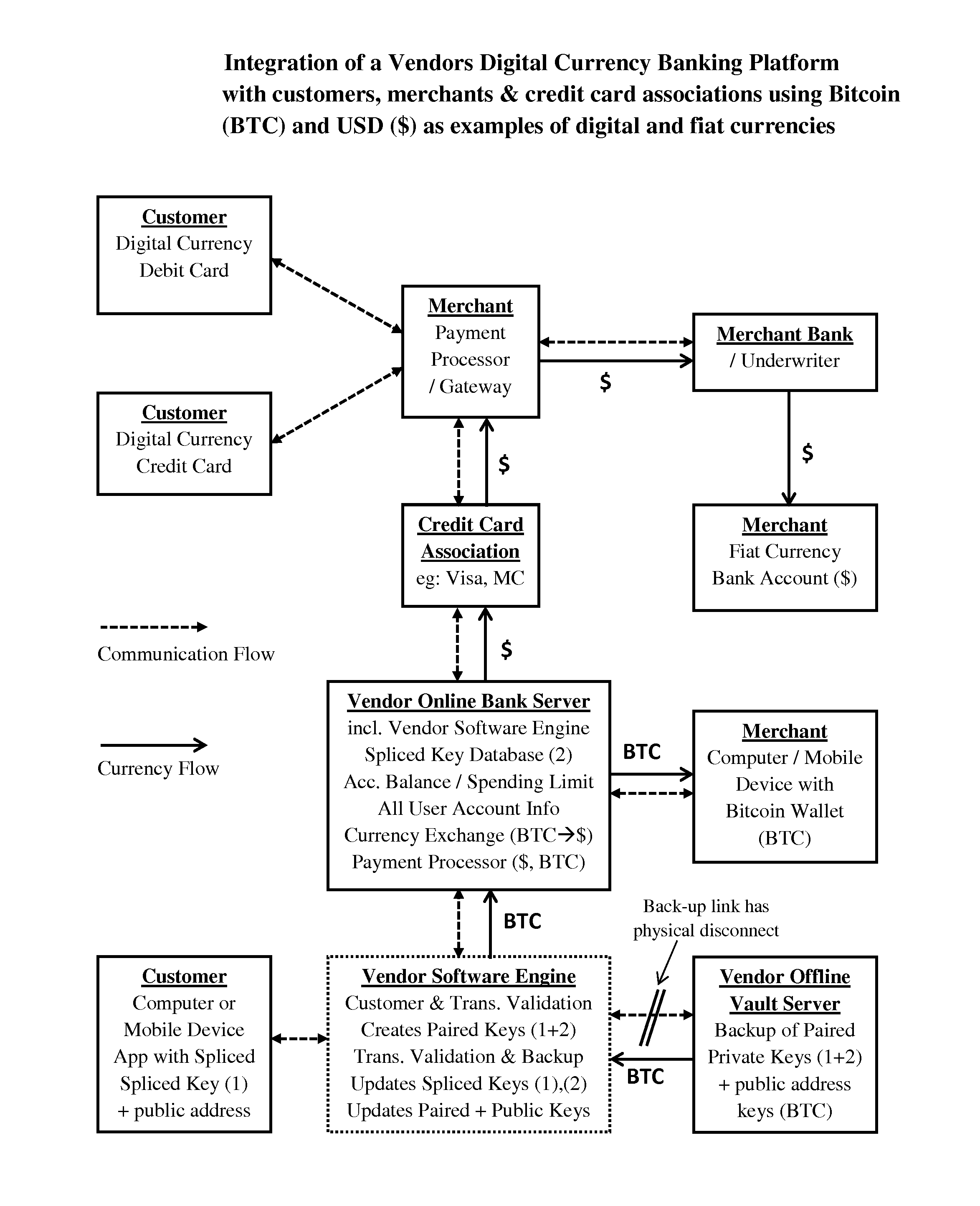

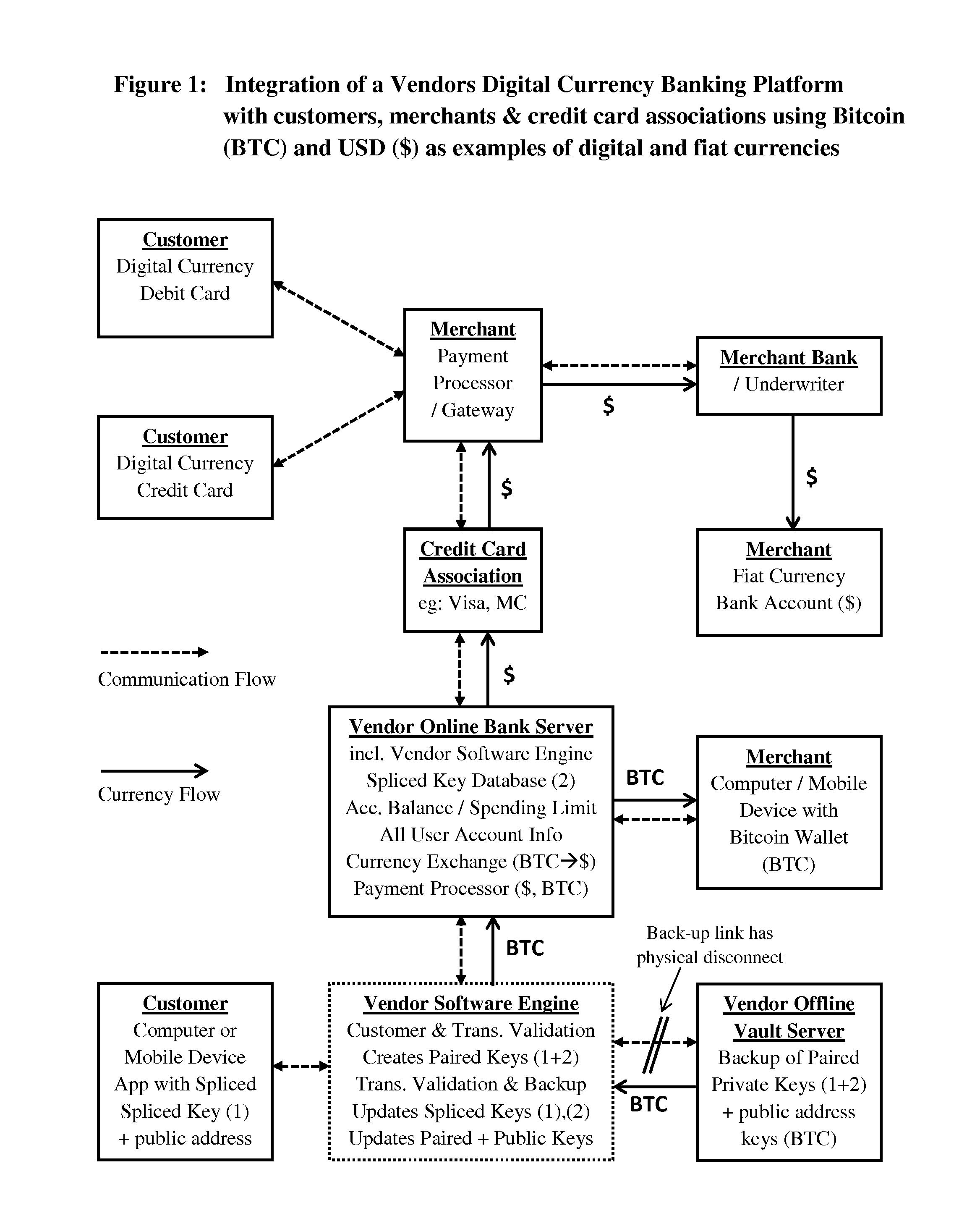

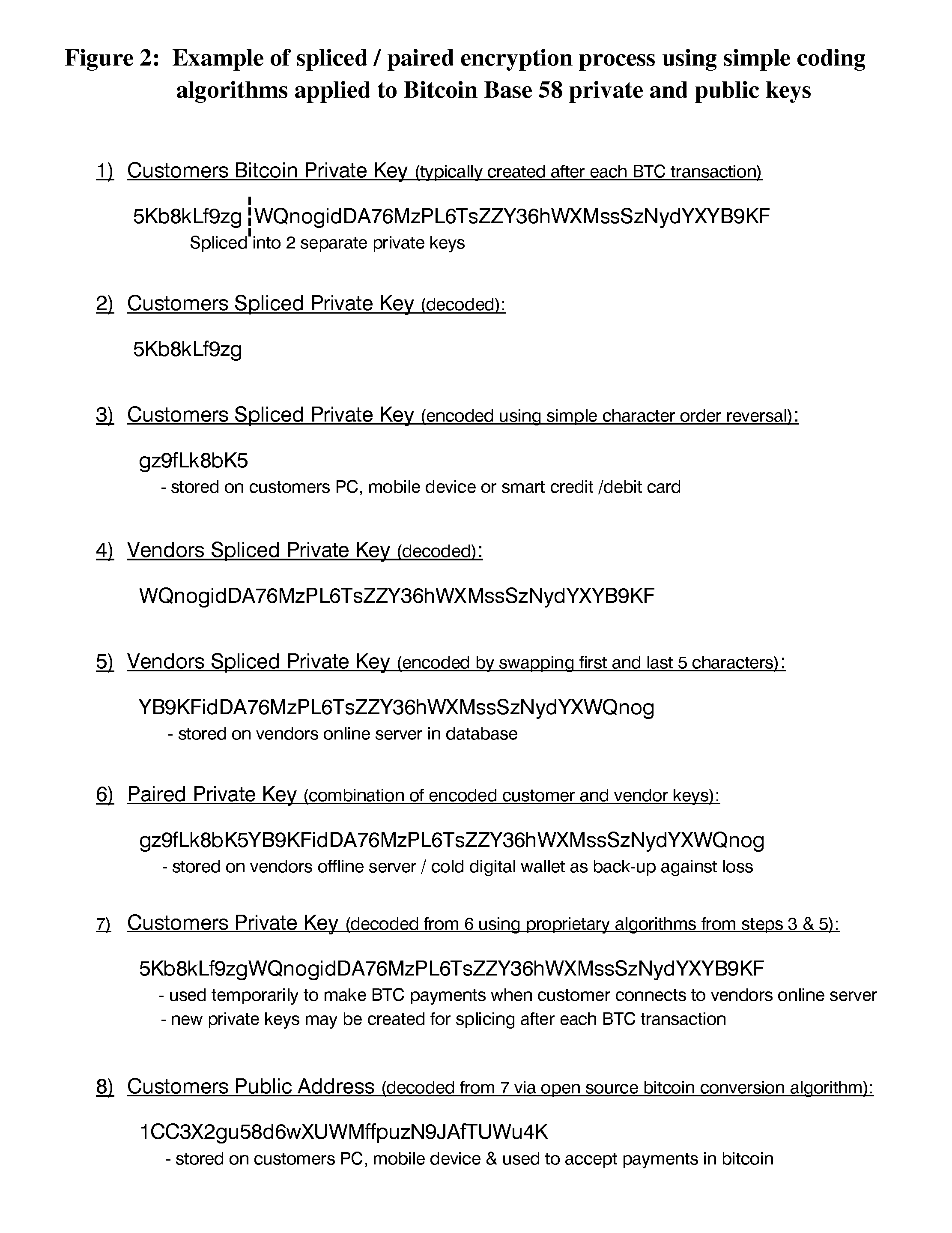

System and method for digital currency storage, payment and credit

InactiveUS20160335628A1Improved credit/debit card security benefitIncreased level securityComputer security arrangementsPayment protocolsDigital currencyStorage security

A system and method for the secure online storage of digital currency or crypto-currency assets, and the secure use of stored online digital currency assets for financial payment transactions and credit lending transactions in either digital currency or fiat currency. The present invention includes various methods for the encryption and secure online storage of a digital currency wallet using spliced / paired design architecture, and various methods for the integration of secure digital currency online wallets with online banking platforms, debit card devices, credit card devices, credit lending networks, merchant payment processors and credit card associations. The present invention also relates to the use of spliced / paired design architecture for non-financial applications that improve the online storage security of other types of data files and document files that are not related to digital currency or financial transactions.

Owner:CRYPTYK INC

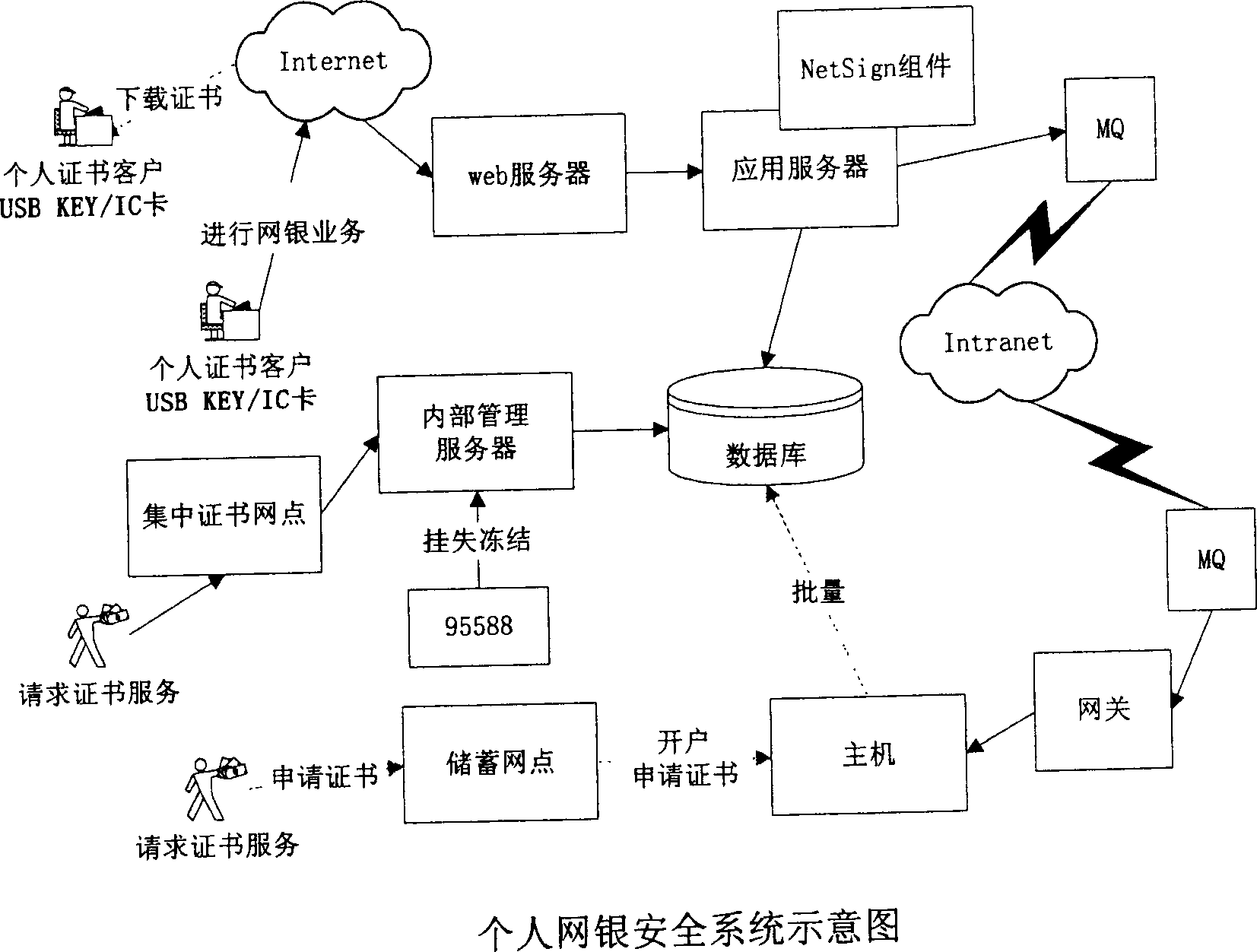

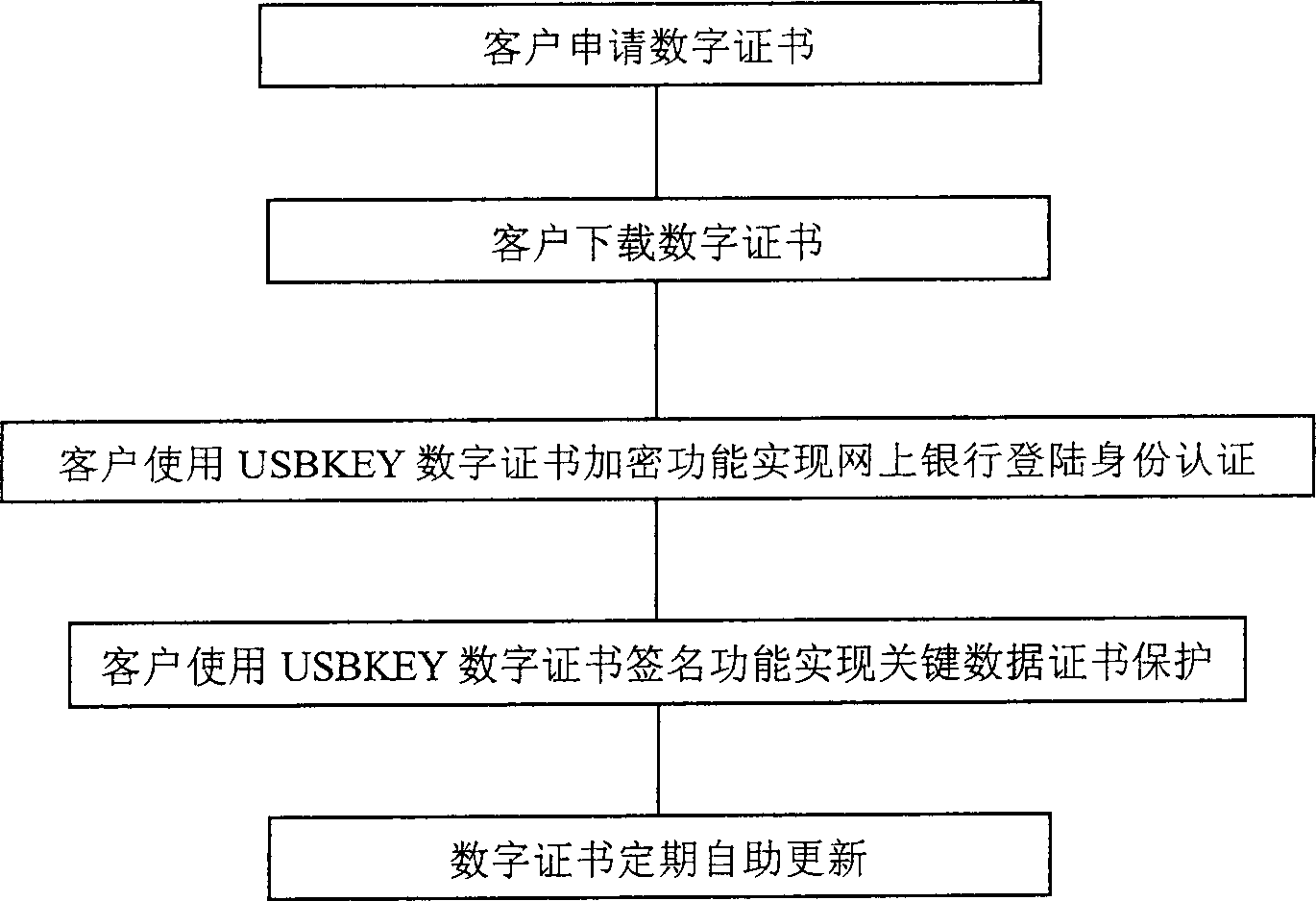

Device and method for proceeding encryption and identification of network bank data

ActiveCN1556449AGuarantee the security of transactionsRealize self-service downloadDigital data processing detailsSpecial data processing applicationsInternal memoryDigital signature

The invention discloses a method of encrypting and certificating network bank data by using a USB KEY, and its characteristics: it includes the steps: a), according to the user information, generating a digital certificate corresponding to the use; b), storing the digital certificate in a USB to be allocated to the user; c), when the user makes a login with the network bank for processing data, it confirms the user ID or digital signature by the USB KEY. It also discloses an implementing device of encrypting and certificating network bank data by using the USB KEY and because every USB KEY has an only serial number and the private key can not leave the internal memory, and it can not make network transaction until the user ID is confirmed, it has high secrecy and safety.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

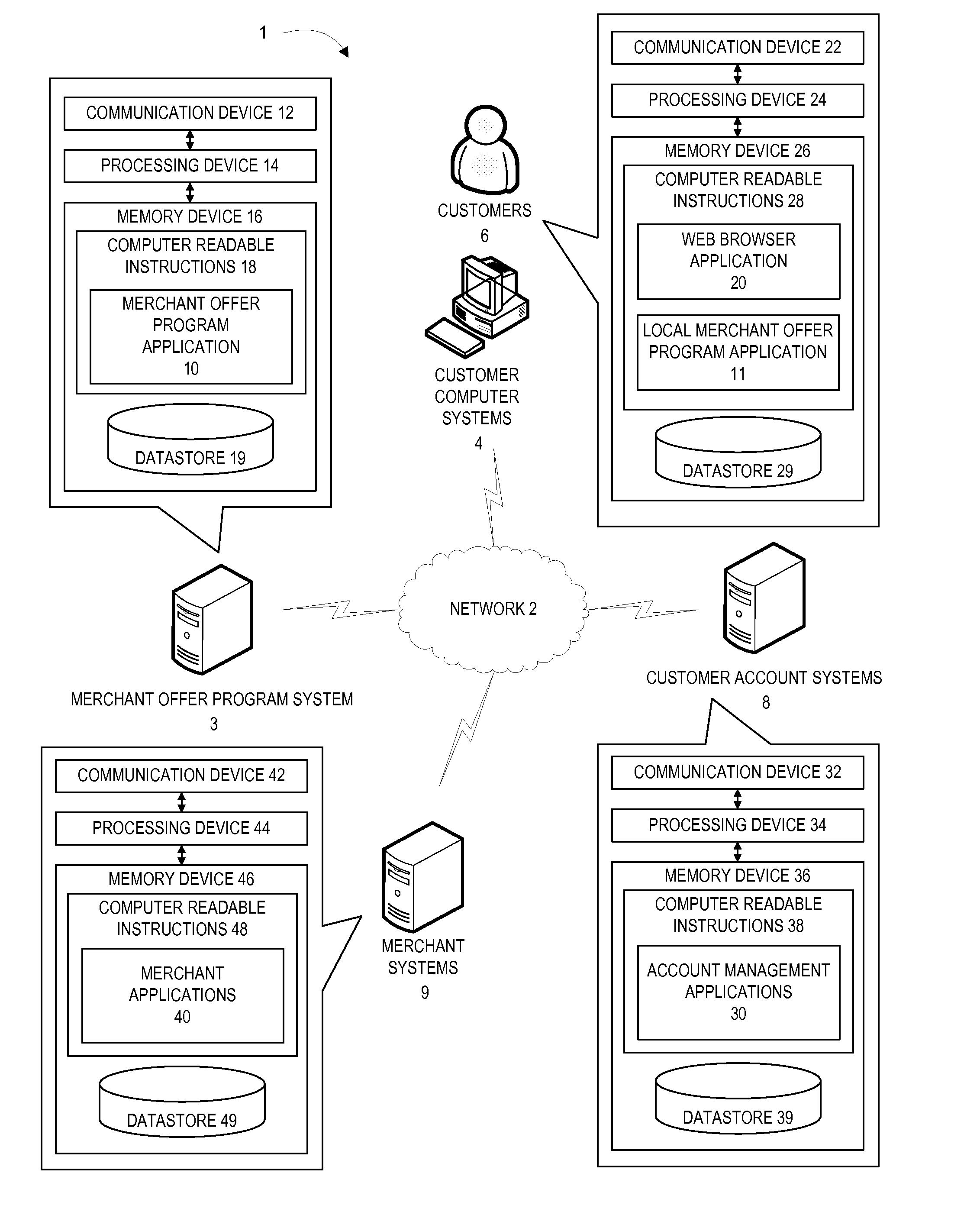

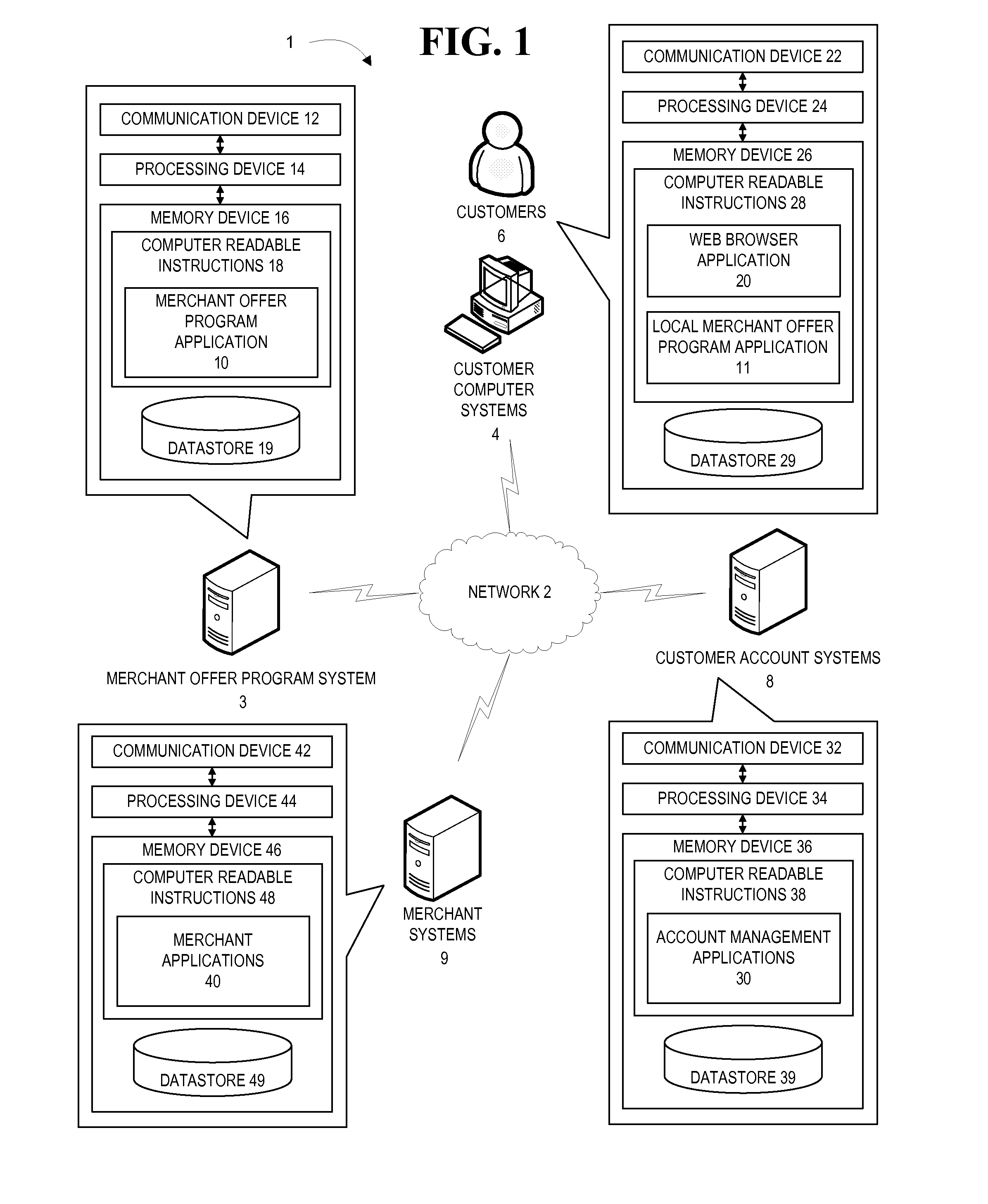

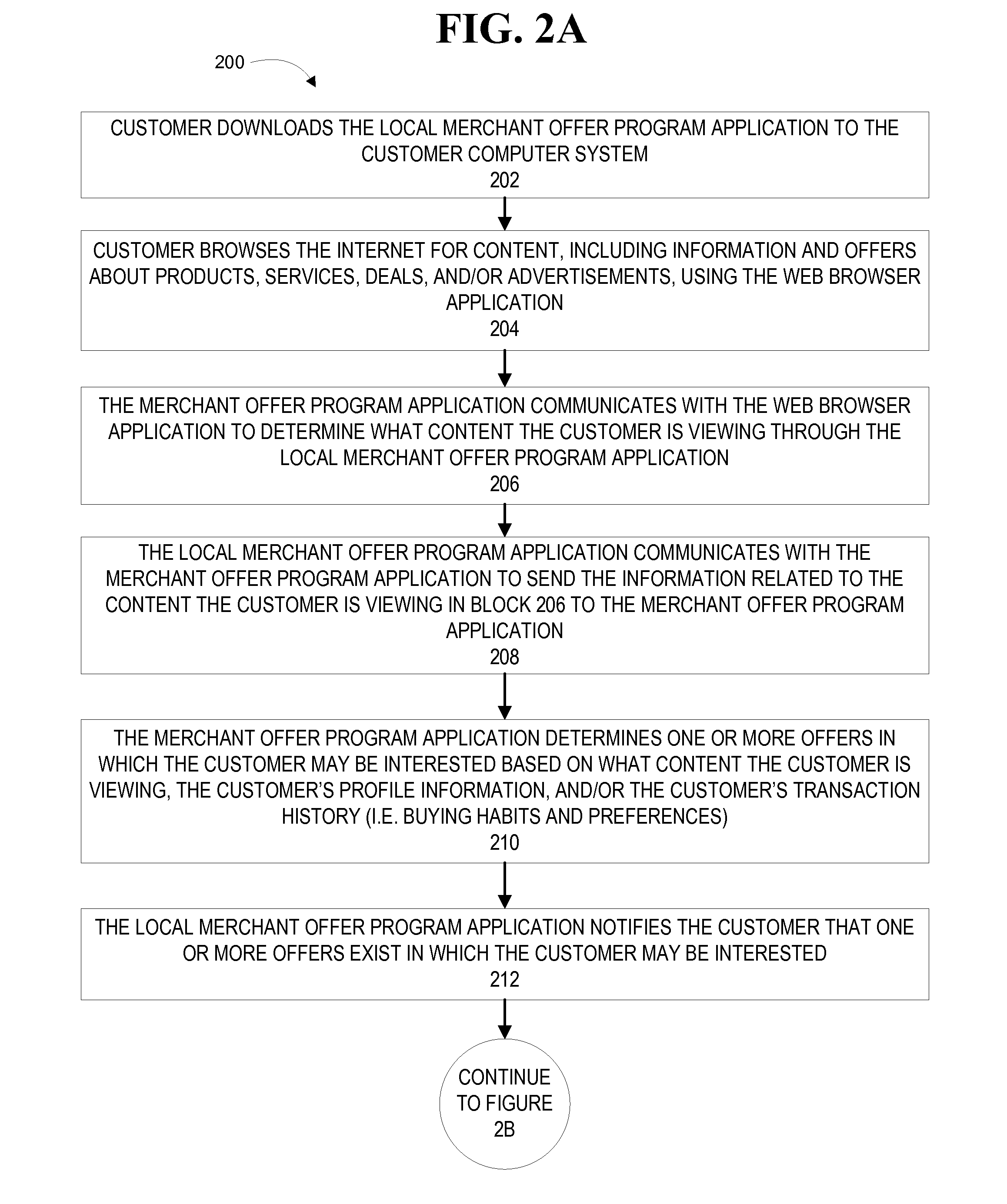

Integrated merchant offer program and customer shopping through online banking statement offers

Embodiments of the invention include a merchant offer program application, which is downloaded onto or accessed through a customer computer, and that works in connection with the customer's accounts at an institution. The merchant offer program application monitors the content in which the customer is interested (i.e. through account transaction history, wish list, website content, etc.). The merchant offer program provides offers that are available for the product in which the customer is interested on an interface, such as an online banking transaction history interface. The offers are associated with the same, similar, or related products to the products associated with the transactions listed on the interface. The customer may select the offer and have the offer (i.e. discount) applied automatically when the customer enters a transaction for the product associated with the offer in the future.

Owner:BANK OF AMERICA CORP

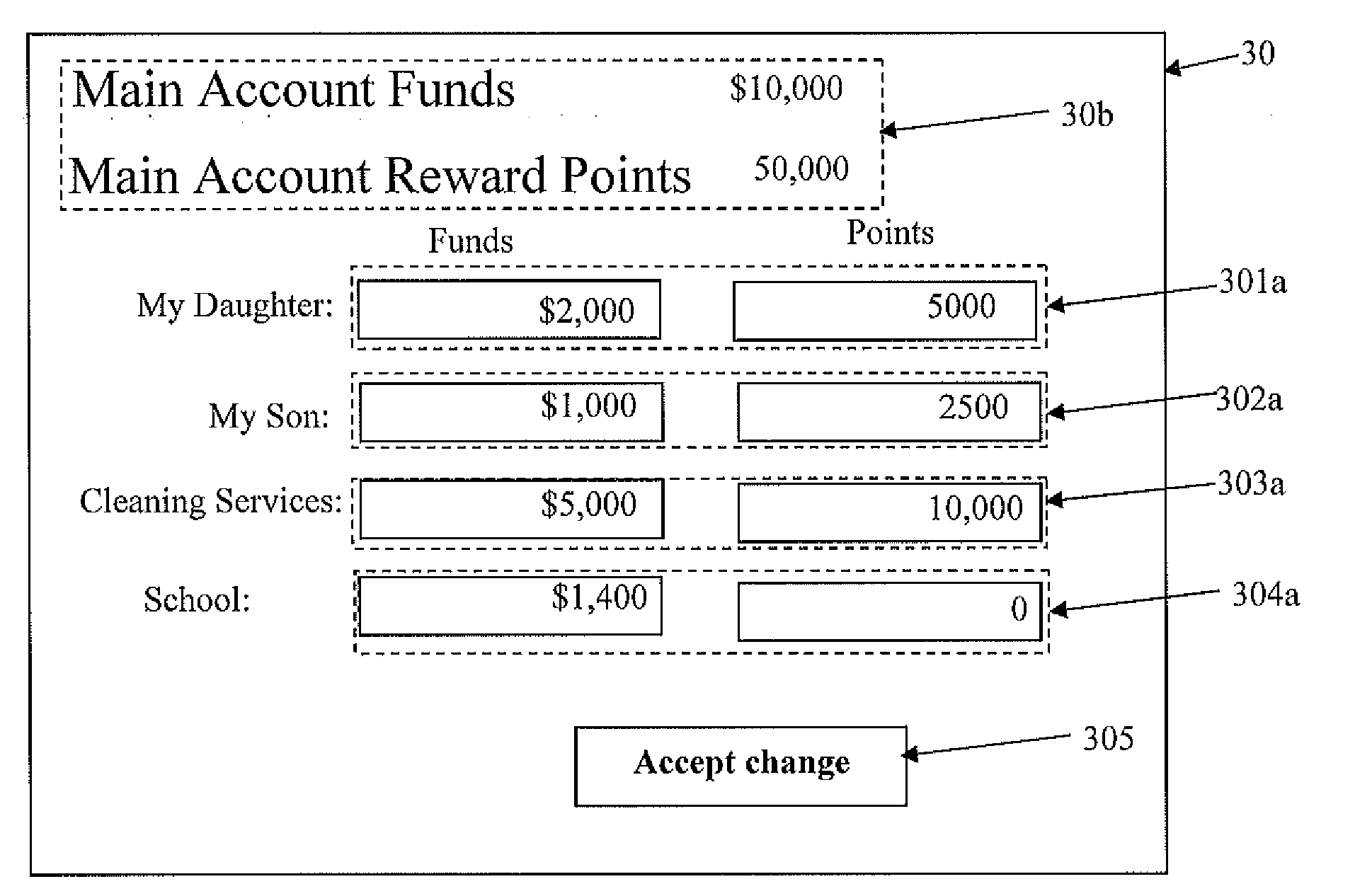

Apparatus and Method for Managing Bank Account Services, Advertisement Delivery and Reward Points

A system to securely and effectively control, process and manage financial services, targeted advertisement delivery, multiple account cards and reward points comprising a web portal or financial institution internet banking portal, offering financial services comprising a secure and effective on-line apparatus and method to manage bank account services, reward points, account cards and advertisement by matching users with advertisers wherein accurate information, such as current personally identifiable financial and transactional information as well as on-line behavioral data, is employed by means to securely process, control and manage financial information located within the premises of the financial institution providing the financial services as one of the criteria for matching advertisers with users.

Owner:EVERTEC GRP LLC

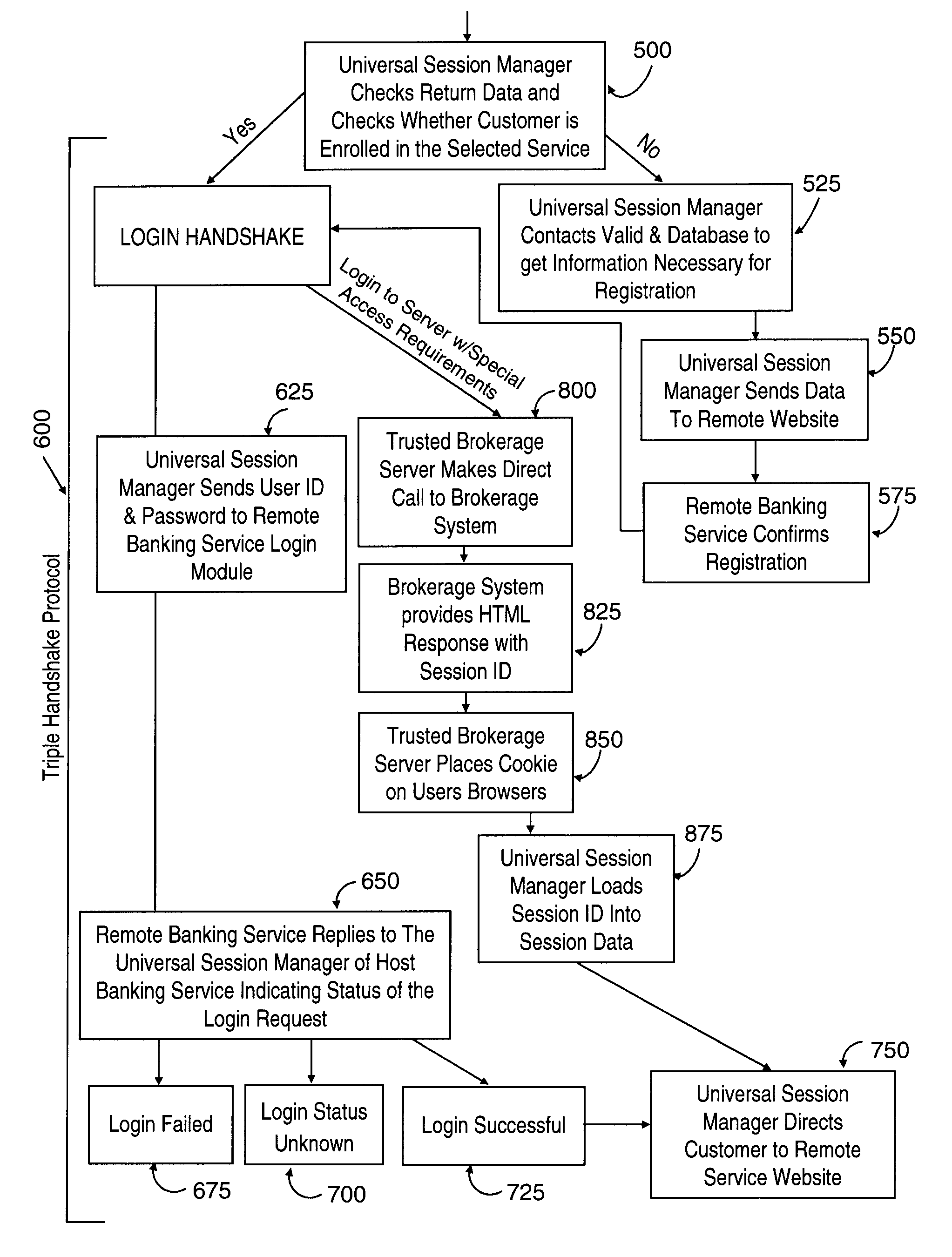

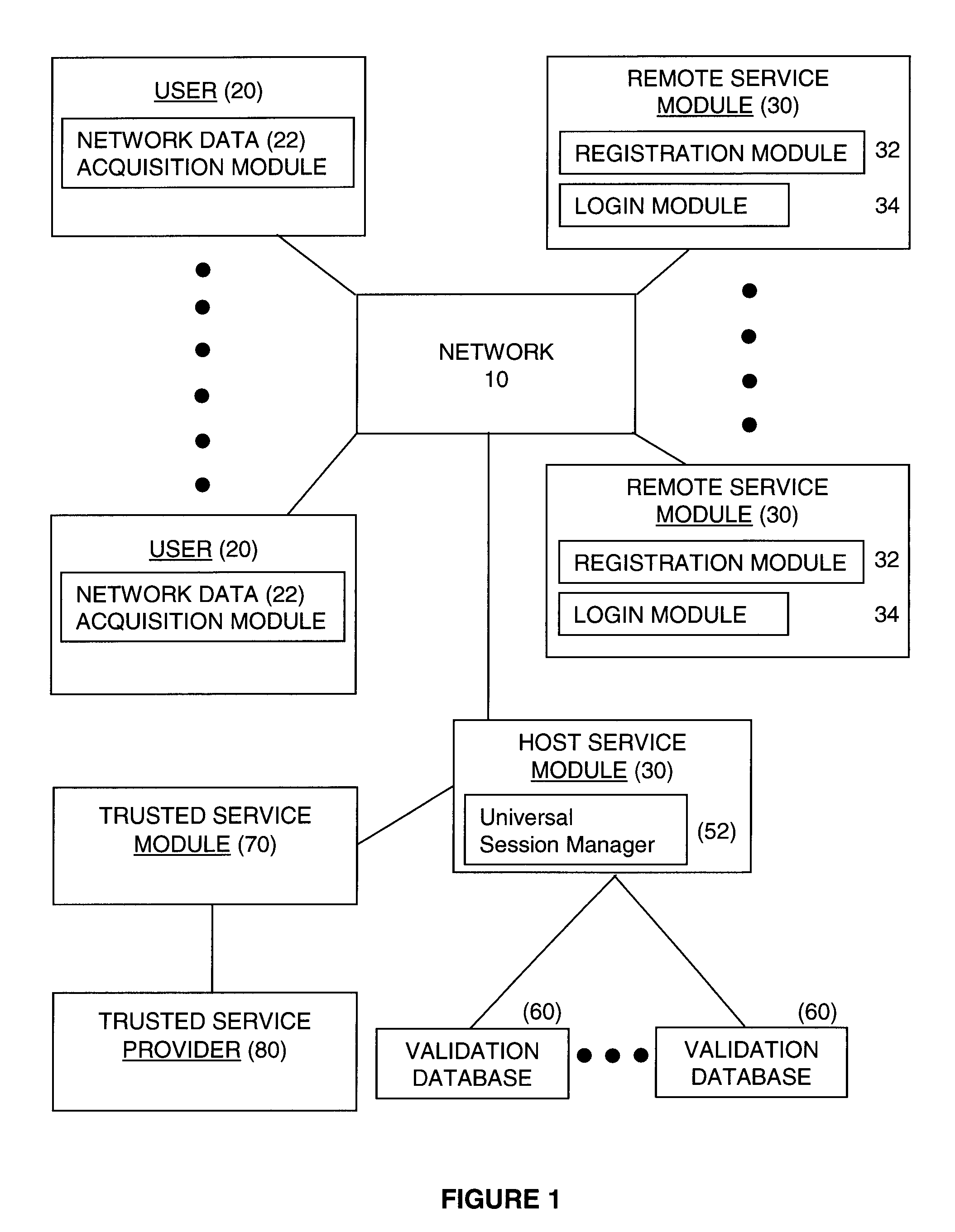

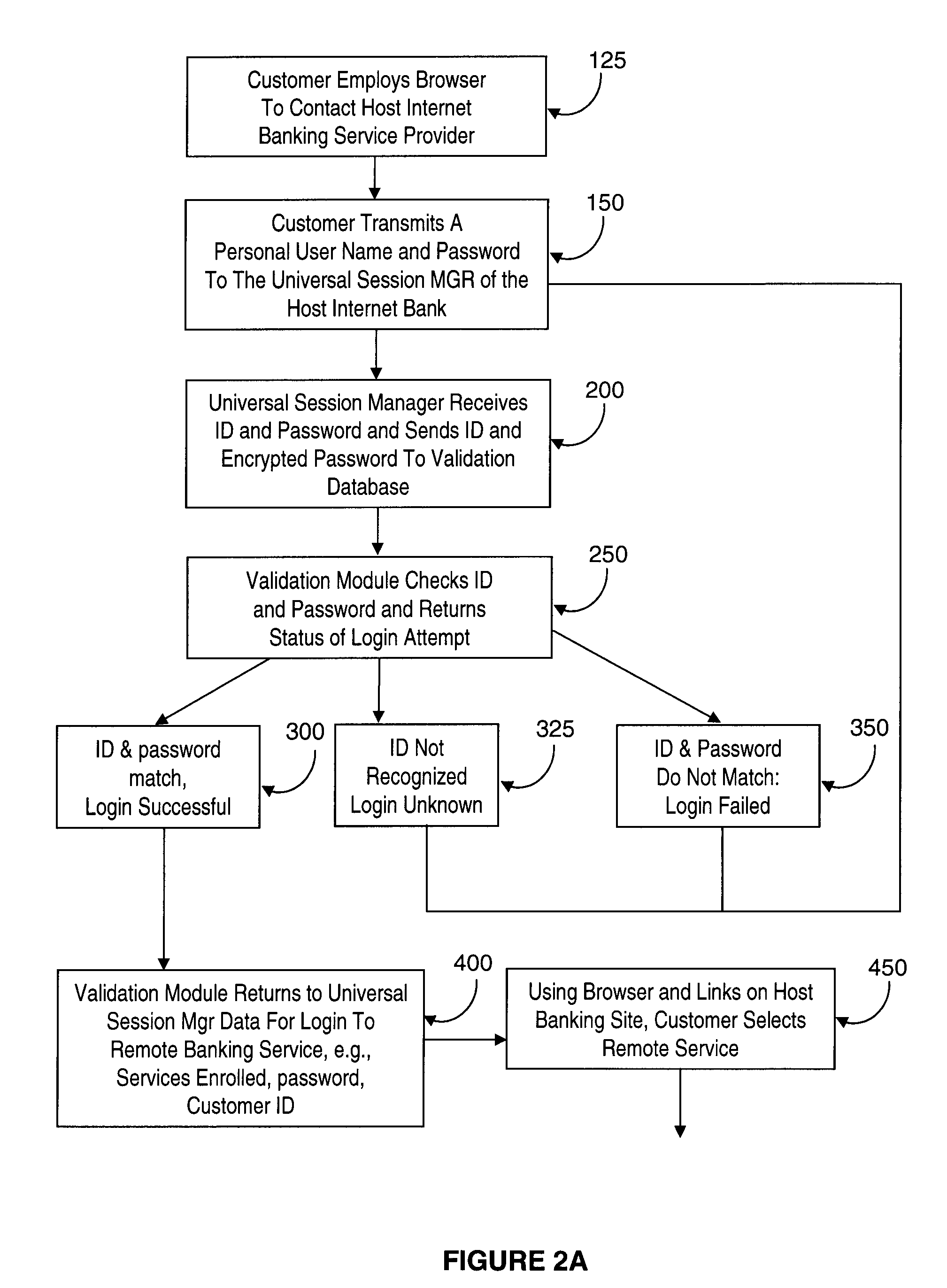

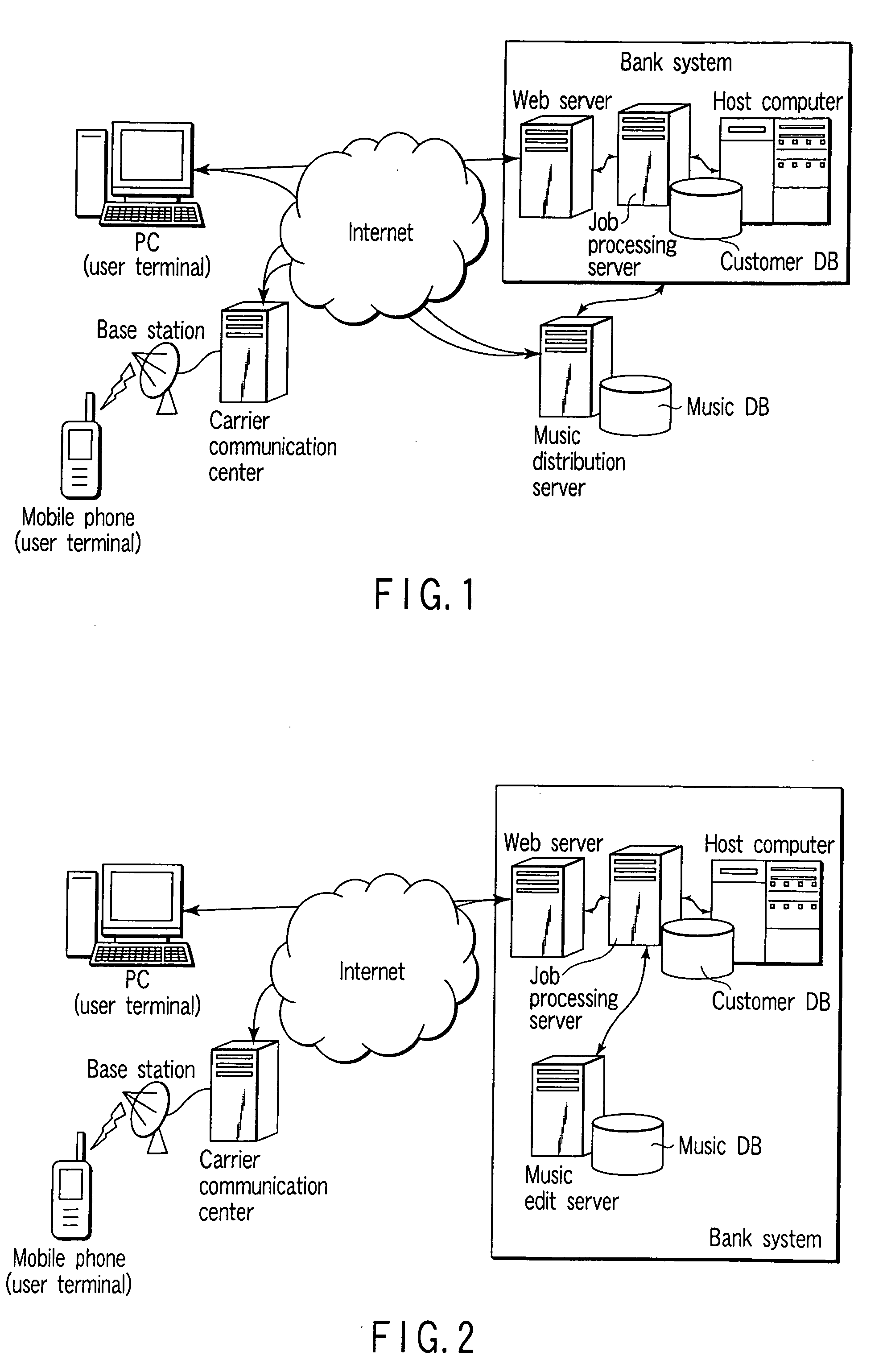

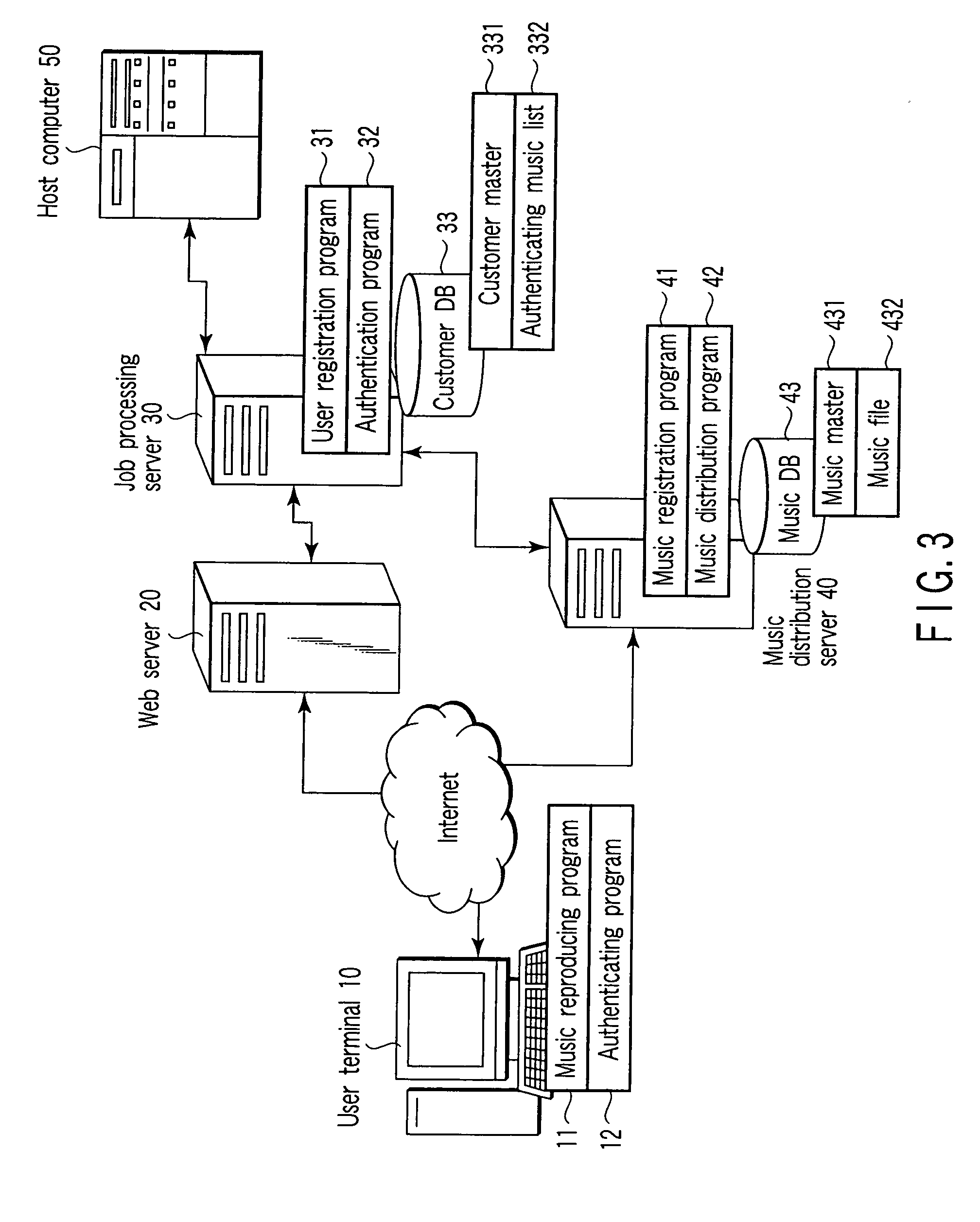

System and method for providing customers with seamless entry to a remote server

The present invention provides a seamless entry system that comprises a universal session manager. Users connect to the host service provider with a unique username and password. Then, through a series of data exchanges between the universal session manager, a validation database, and the remote service module, the customer may be transparently logged into remote service providers. Internet banking customers utilize a browser system to connect to a host server providing a range of banking services supported by a remote or distinct server. According to the method, the customer first enters a username and password to gain access to the host service provider. The universal session manager transmits data required for login to the remote service provider. The user is thus able to utilize the remote services with his / her web browser system without having entered a username or password particular to the remote service.

Owner:CHASE BANK USA NAT ASSOC

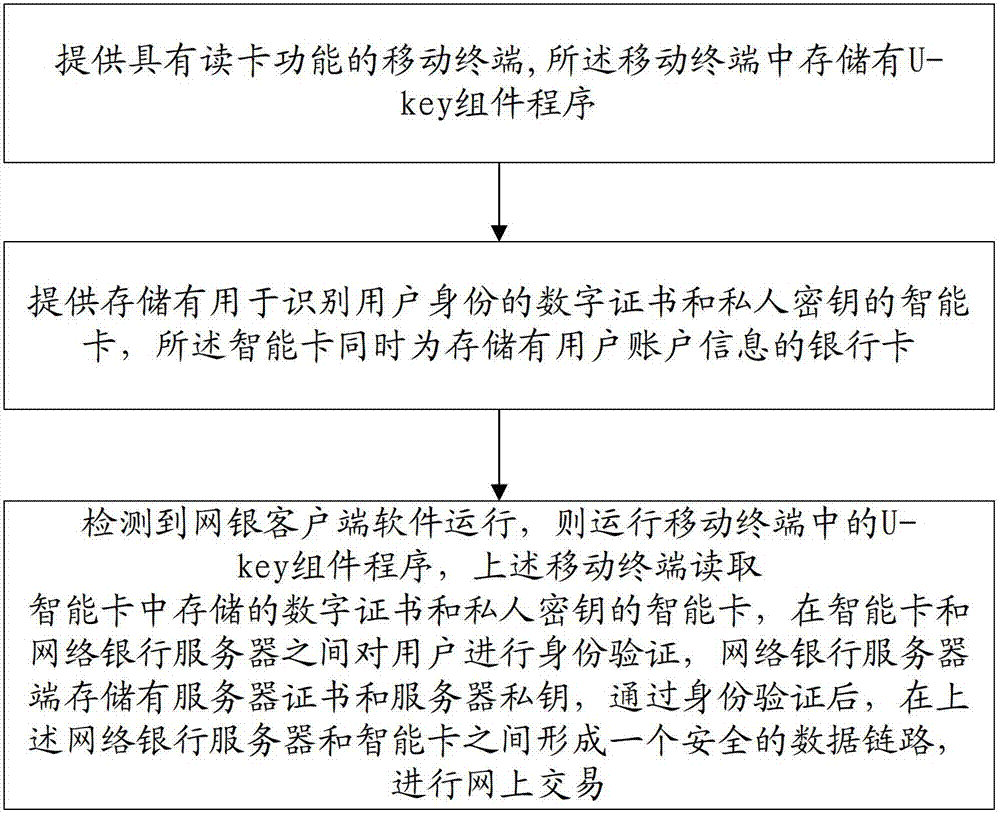

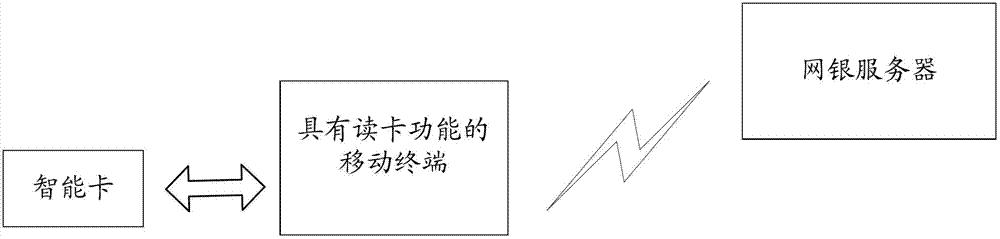

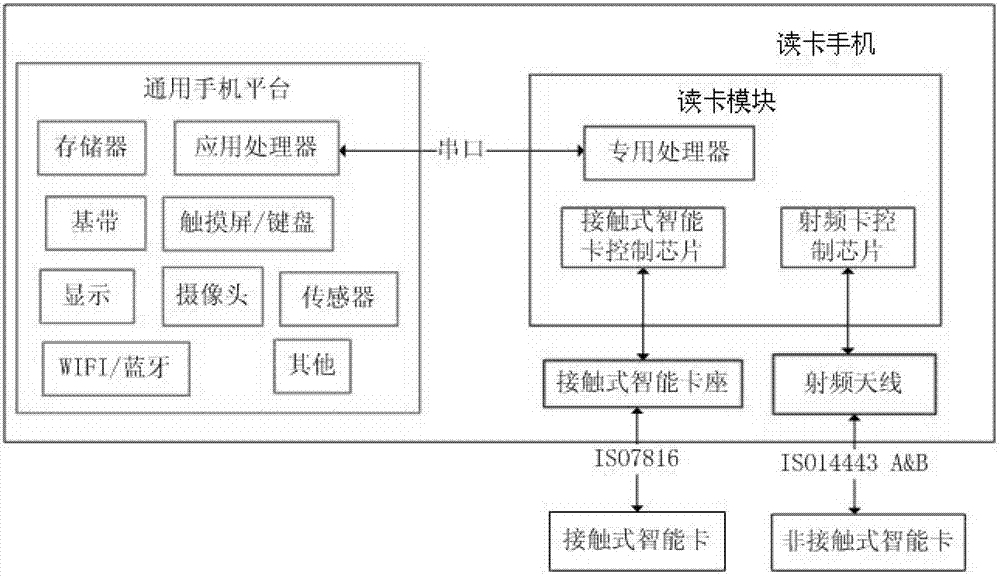

Internet bank security authentication method and system

ActiveCN102737311ASafe and convenient transaction methodPayment protocolsSmart cardComputer terminal

The invention discloses an internet bank security authentication method which comprises the steps of: providing a mobile terminal with a card reading function, wherein U-key assembly program is stored in the mobile terminal; providing an intelligent card stored with a digital certificate and a private key, wherein the digital certificate and the private key are used for identifying user identity, and the intelligent card is also used as a bank card for storing information of a user account; reading the intelligent card for storing the digital certificate and the private key by the mobile terminal, conducting identity authentication on a user between the intelligent card and an internet bank server side, wherein internet bank server side is used for storing a server certificate and a server private key; and after the identity authentication is passed, forming a safety data link between the internet bank server side and the intelligent card so as to conduct networked transaction. According to the invention, the safety information is stored in the intelligent card, safety and convenient transaction can be realized by the mobile terminal and user identity authentication between the intelligent card and the internet bank server side. The invention further discloses an internet bank security authentication system.

Owner:FUJIAN LANDI COMML EQUIP CO LTD

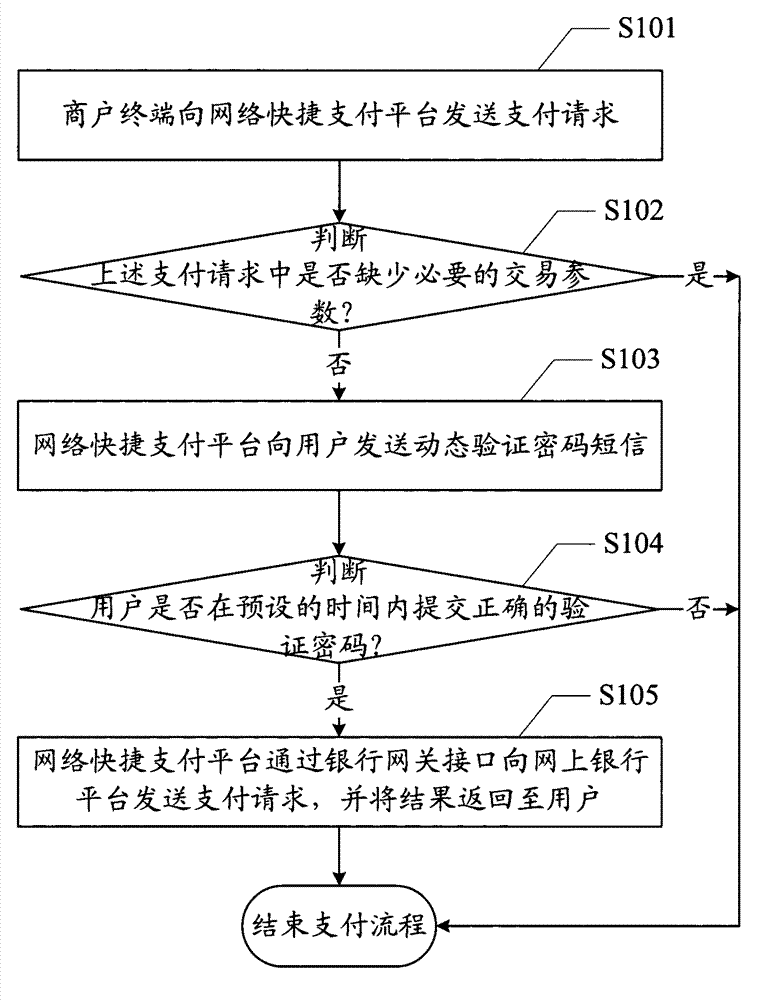

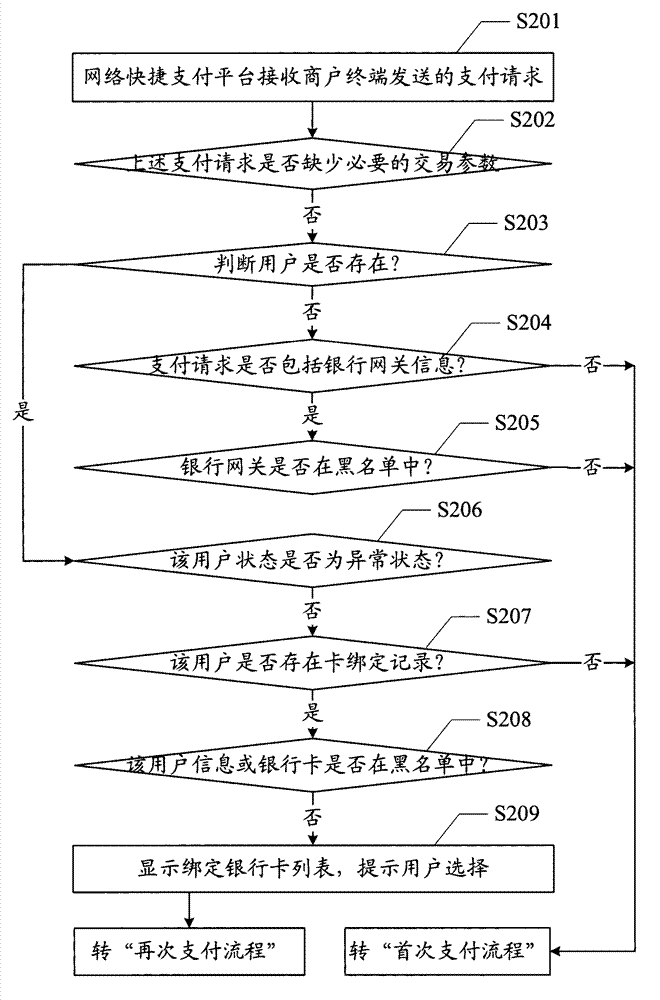

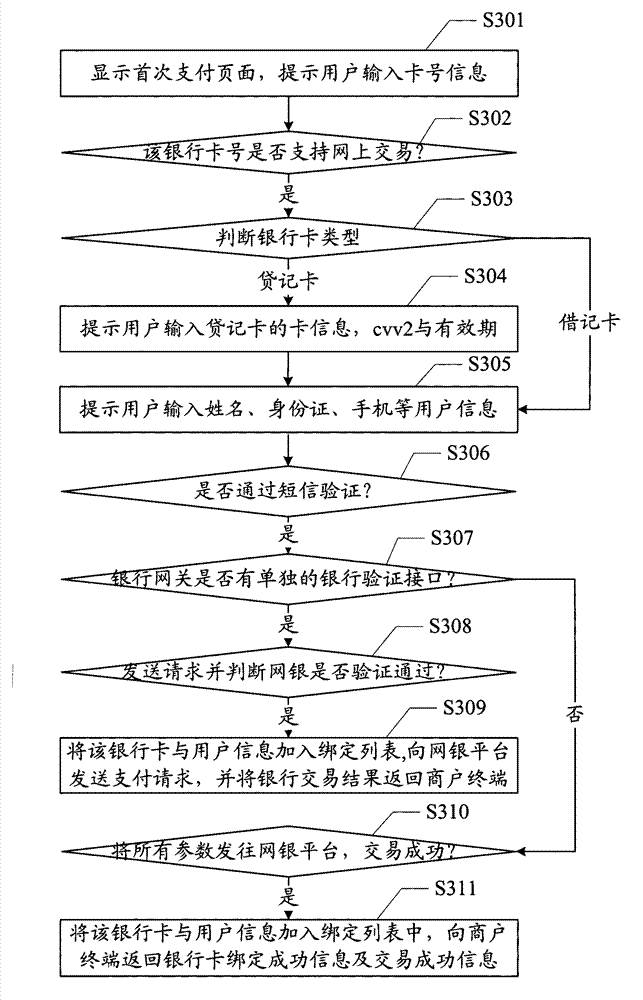

Quick internet payment method and system

InactiveCN102880959AMeet fast and convenient payment needsSolve the high failure rate of paymentPayment protocolsThird partyFailure rate

The invention provides a quick internet payment method and system. The quick internet payment method comprises the following steps: correcting the necessary transaction parameters included in a payment request after receiving the payment request of the user by a quick internet payment platform; ending the payment process if the necessary transaction parameters are not sufficient; sending the short message with the dynamic authentication password to the user by the quick internet payment platform, authenticating whether the user submits the right dynamic authentication password in the preset time or not, and ending the payment process if the user does not submit the right dynamic authentication password in the preset time; sending the payment request to an internet bank platform through a bank gateway interface, and returning the bank payment result to the user. On the basis of the scheme of the invention, the user does not need to additionally register the account of the payment company of the third party and finishes the payment process by inputting the dynamic authentication password of the short message without logging in after binding the bank card. The problems of more payment links, high paying failure rate due to complex process and poor user experience in the prior art are solved.

Owner:汇付天下有限公司

New method for using the mobile number bond with account for identity identification

InactiveCN101087193AUser identity/authority verificationData switching by path configurationMobile Telephone NumberRemote control

The invention relates to the information security field of computer and network, relates to ID attestation system and method, and it can prevent the user account from stolen. The method uses the mobile phone to do network ID attestation, distinguish the computer by the affirmed strings, and the user account and mobile phone can correspond with client computer one by one to identify the validity of user ID. The method can be used in various account affirmations of network services (web management, e-mail, e-business, network game, chatting tool, network bank and the field of remote control), and it also can be used other service relative with network (the operation of ATM). It is a efficient method to prevent the network form being stolen.

Owner:马骏

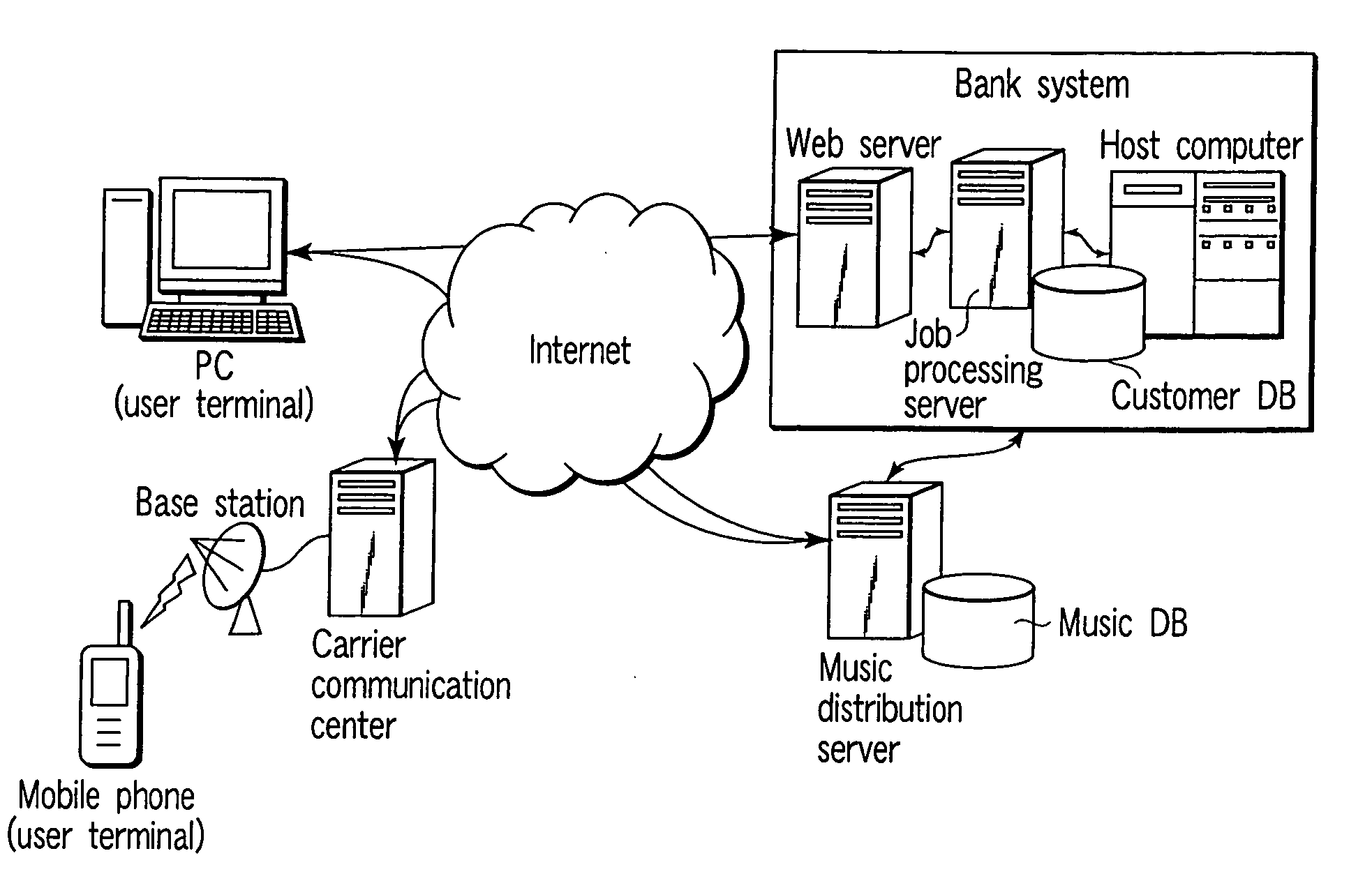

Person oneself authenticating system and person oneself authenticating method

InactiveUS20090094690A1Improve securityReduce the burden onDigital data processing detailsUser identity/authority verificationUser authenticationAuthentication server

There is provided person oneself authenticating means for authentication of a user, which is mainly used for person oneself authentication in Internet banking or the like and is high in security, and is realizable by functions ordinarily provided in a PC, a mobile phone, or the like, the authenticating means being less in burden required for user authentication key management and authentication operations. Sound or an image is adopted as an authentication key for person oneself authentication. Authentication data is edited by combining an authentication key, which is selected by a registered user, and sound or an image that is other than the authentication key, and the authentication data is continuously reproduced in a user terminal. A time in which a user has discriminated the authentication key from the reproduced audio or video is compared with a time in which the authentication key should normally be discriminated, which is specified from the authentication data. When both times agree, the user is authenticated as a registered user.

Owner:THE BANK OF TOKYO-MITSUBISHI UFJ

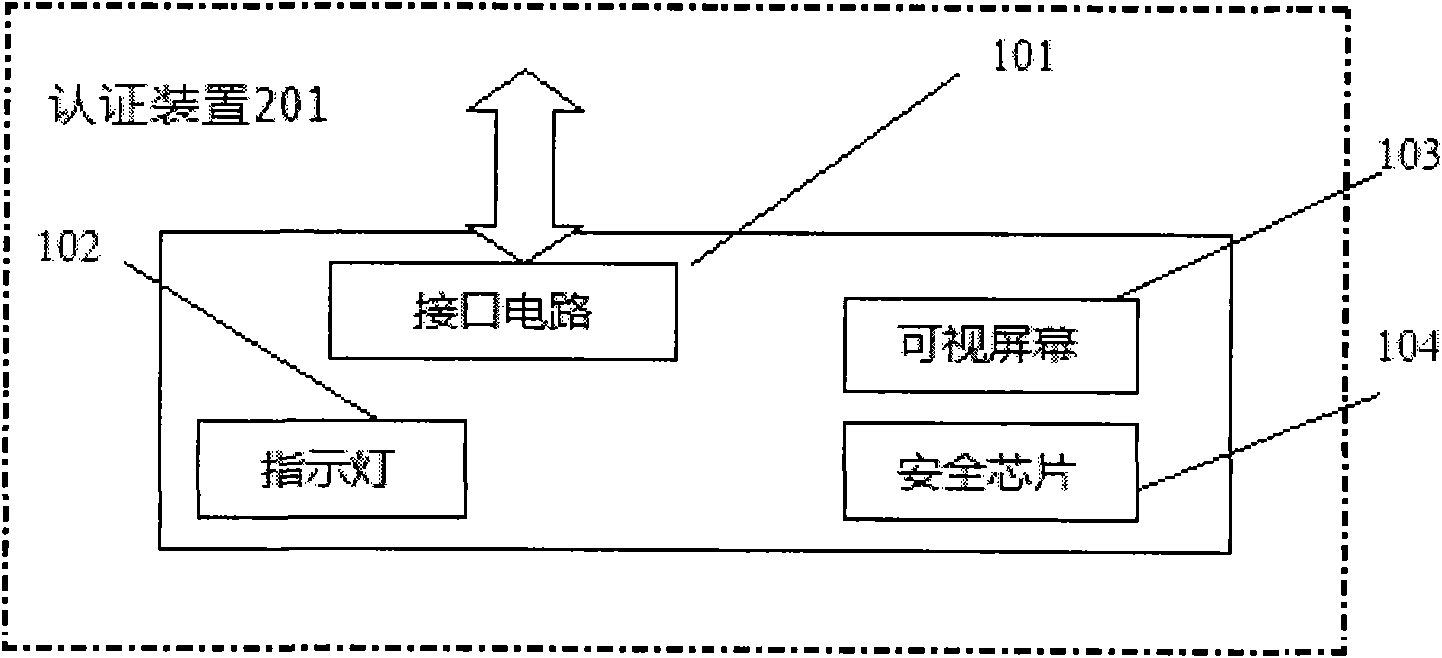

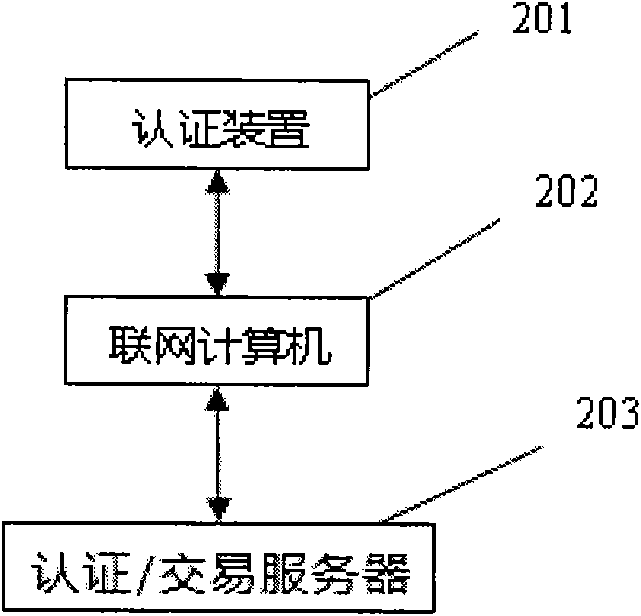

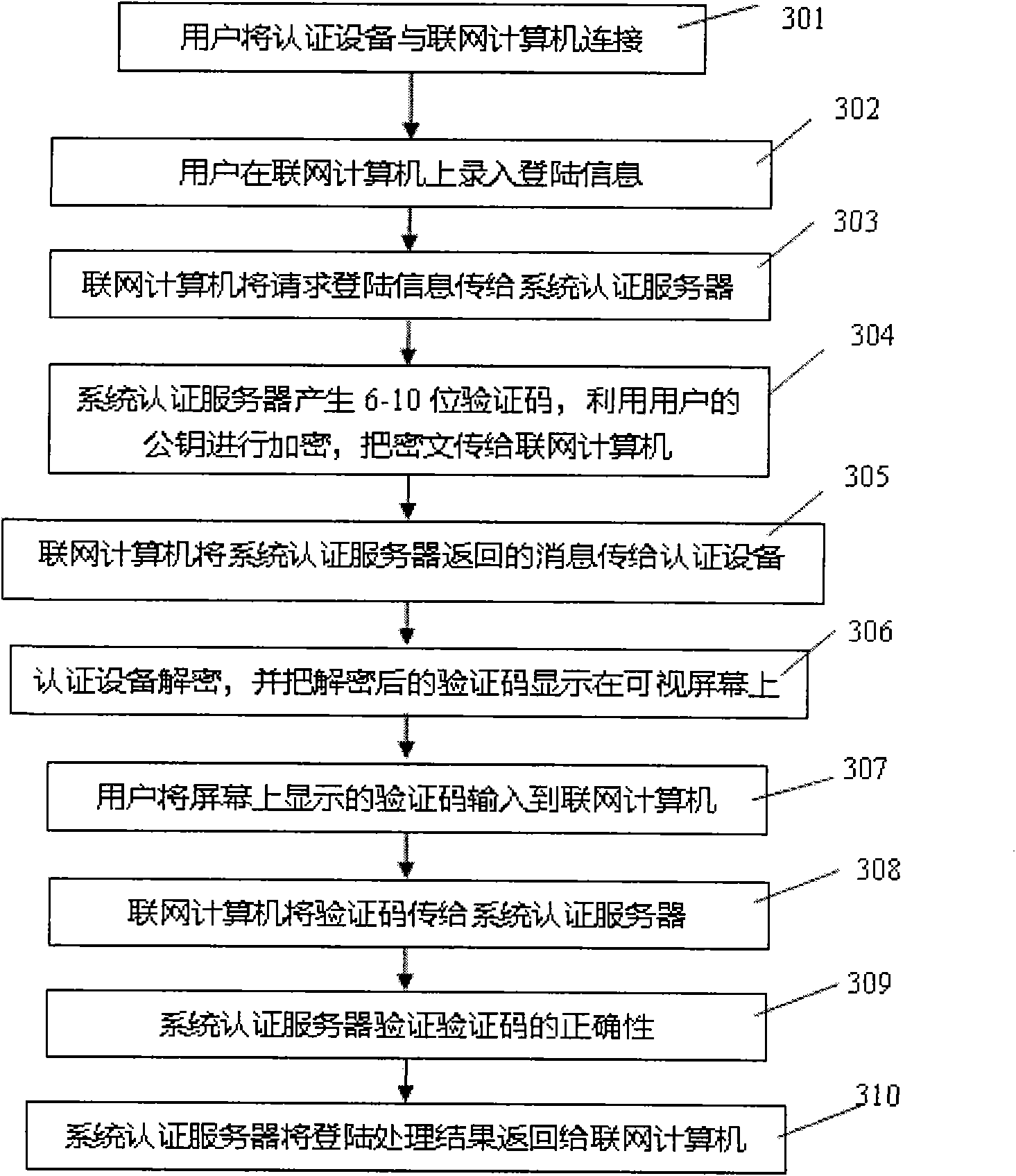

Authentication device and system and method using same for on-line identity authentication and transaction

InactiveCN101848090AImprove securityEnsure safetyFinanceUser identity/authority verificationTransaction serviceRemote control

The invention discloses an authentication device comprising an interface circuit, an indicator light, a visual screen and a safe chip, wherein the safe chip comprises a digital certificate, a private key, an encryption / decryption module and a digital signature module. The system which uses the authentication device for on-line identity authentication and transaction comprises an authentication device, a networking computer and an authentication / transaction computer. The method which uses the authentication device for on-line identity authentication and transaction has the key point that the authentication device decrypts encrypted information sent by an authentication / transaction server and carries out digital signature, and the authentication / transaction server verifies decryption information fed back by the authentication device. The invention improves the safety of on-line identity authentication and transaction by the visual screen, the encryption / decryption module and the digital signature module which are arranged in the authentication device and by the interactive cooperation of users and the authentication / transaction server, can effectively avoid the problems of Internet banking transaction hijacking, transaction falsification and remote control to embezzle user funds.

Owner:WUHAN LUOJIA NEW CENTURY INFORMATION

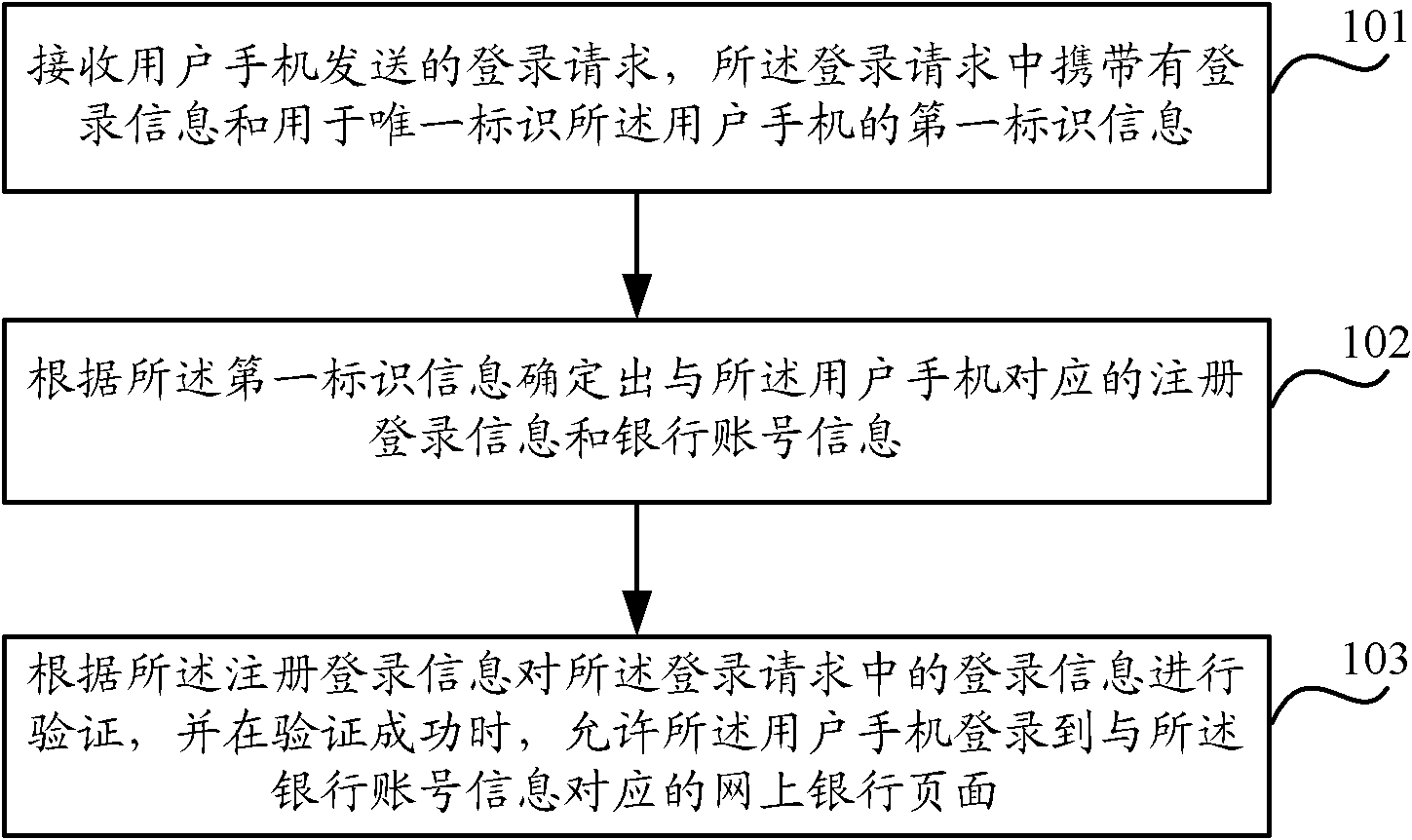

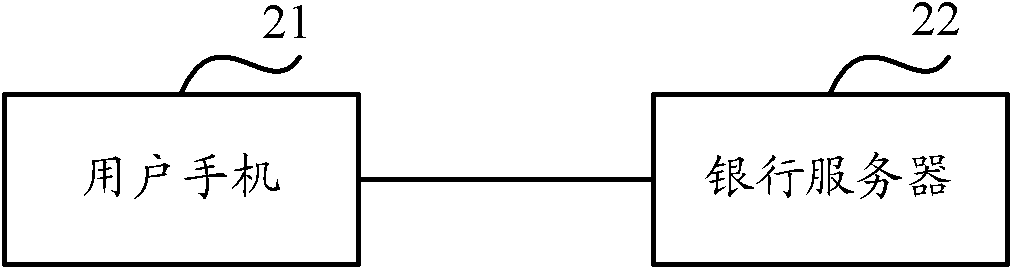

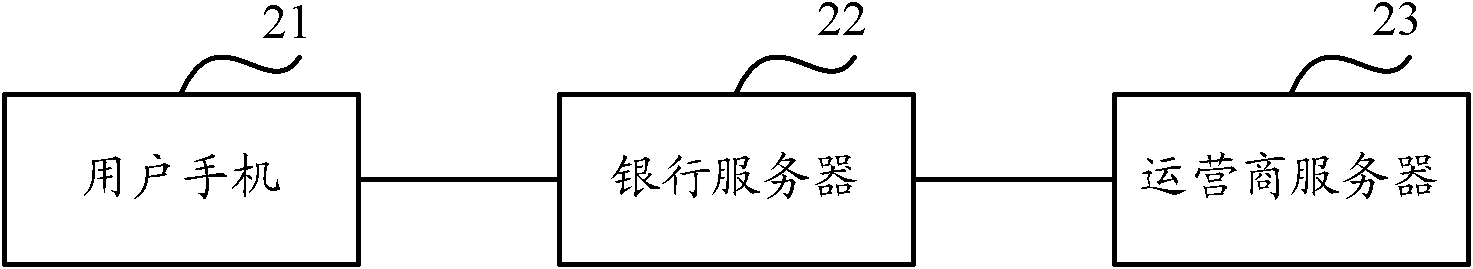

Method and system for logging onto online bank with mobile phone, and bank server

InactiveCN102118743AIncrease the difficulty of crackingImprove securityFinancePayment architectureComputer scienceMobile phone

The invention discloses a method and a system for logging onto an online bank with a mobile phone, and a bank server for purpose of enhancing the security, validity and reliability of logging onto the online bank with a mobile phone of a user. The method comprises the following steps: a login request sent through the mobile phone of the user is received and carried with login information and first identification information used for uniquely identifying the mobile phone of the user; the registration login information and the banking account information corresponding to the mobile phone of the user are determined according to the first identification information; and the login information in the login request is verified according to the registration login information, and when the login information in the login request is successfully verified, the mobile phone is allowed to be logged onto the online banking page corresponding to the banking account information. By adopting the technical scheme, the security, validity and reliability of logging onto the online bank with the mobile phone of the user are enhanced.

Owner:ZTE CORP

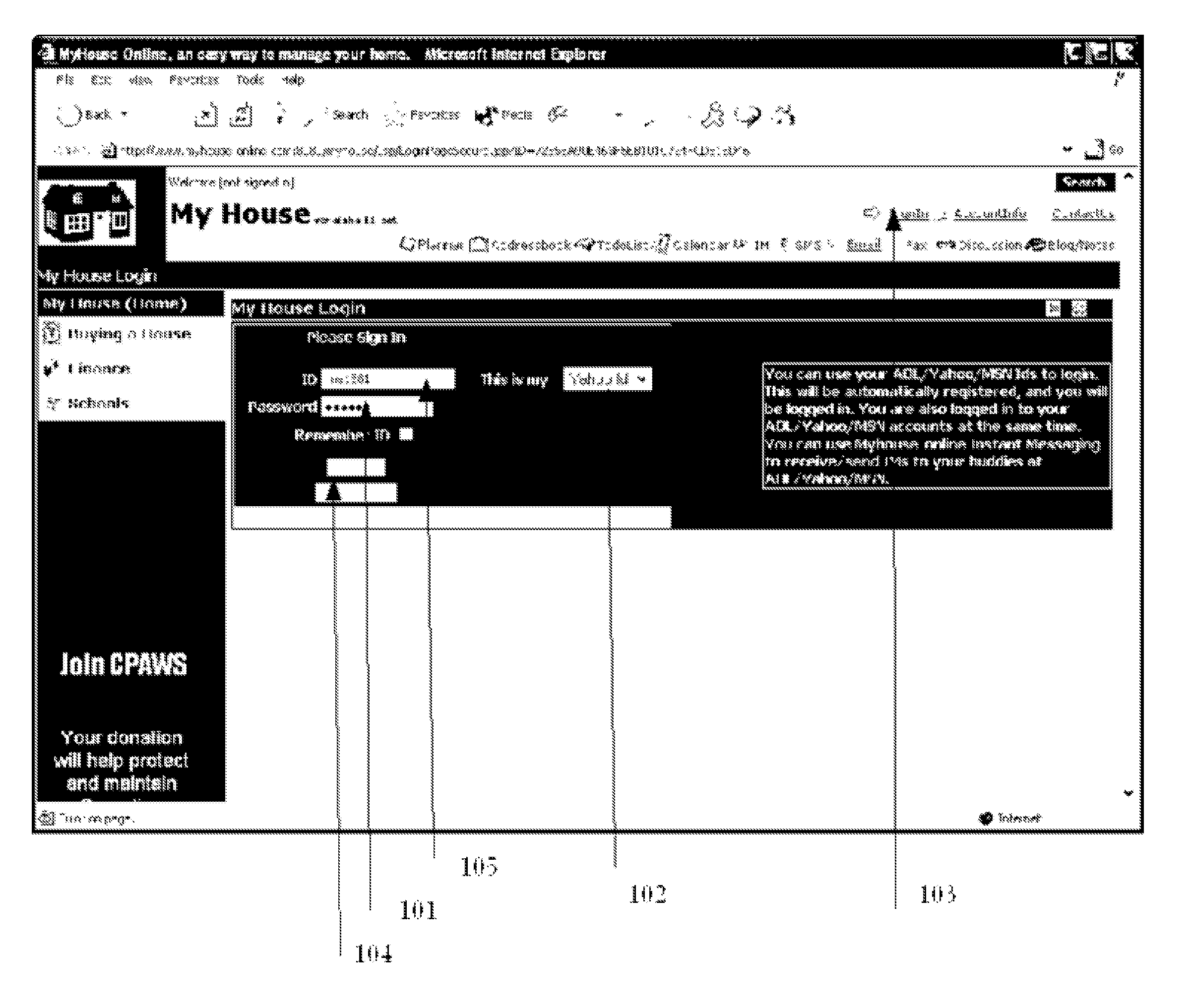

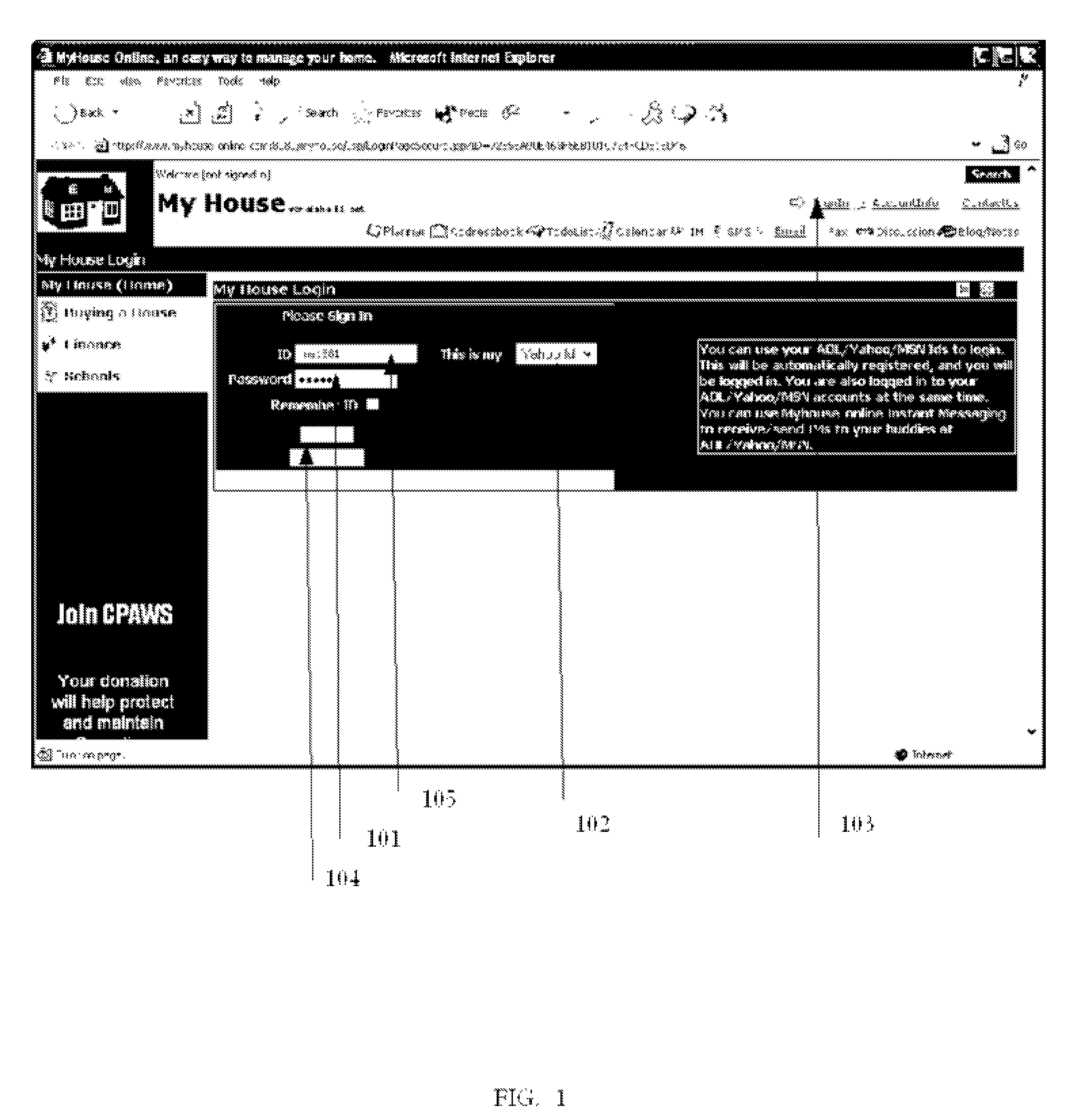

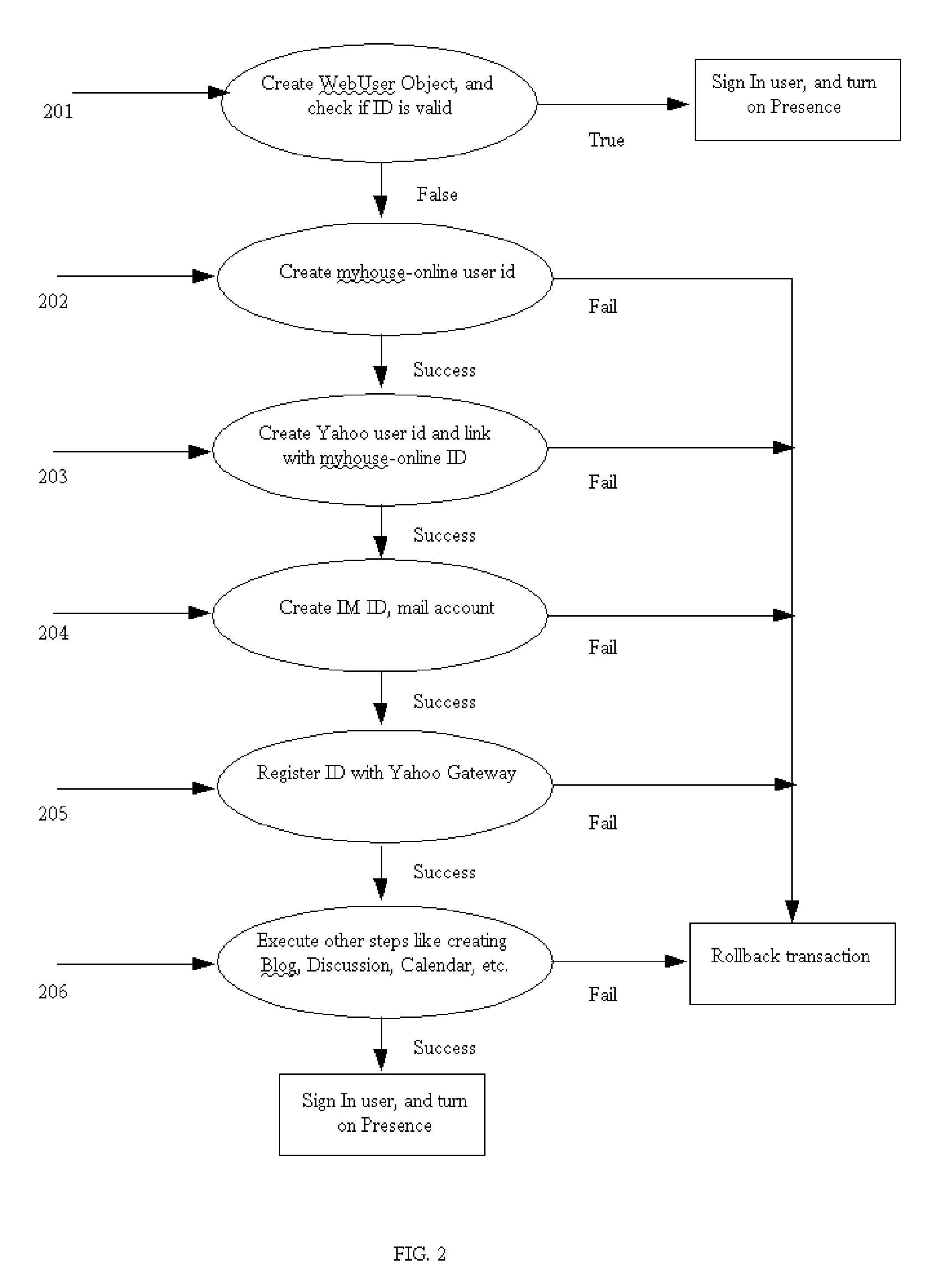

Using Popular IDs To Sign On Creating A Single ID for Access

InactiveUS20060064502A1Improve user experienceSignificant problemMultiple digital computer combinationsDigital data authenticationMobile Telephone NumberPassword

Every being has a presence and can be associated with an ID. Popular IDs such as AOL ID, Yahoo ID, MSN ID, SIP ID, or PSTN and mobile telephone numbers, etc. are used by people to read their emails, send IMs, talk, interact, watch TV, etc. IDs such as biometrics IDs and social security IDs, RFIDs, etc. are used for more secure access. But, these popular IDs cannot be used for other purposes like logging on to ENeedsOnline auction process or making a purchase online or banking online, etc. The present invention describes a way to improve a user's experience of signing in and creating a presence, and associating these popular IDs with a Single ID allowing access to portals, online banking, shopping, etc. It also solves the bigger problem of keeping track of multiple IDs and the passwords associated with the IDs.

Owner:TRANSAXTIONS

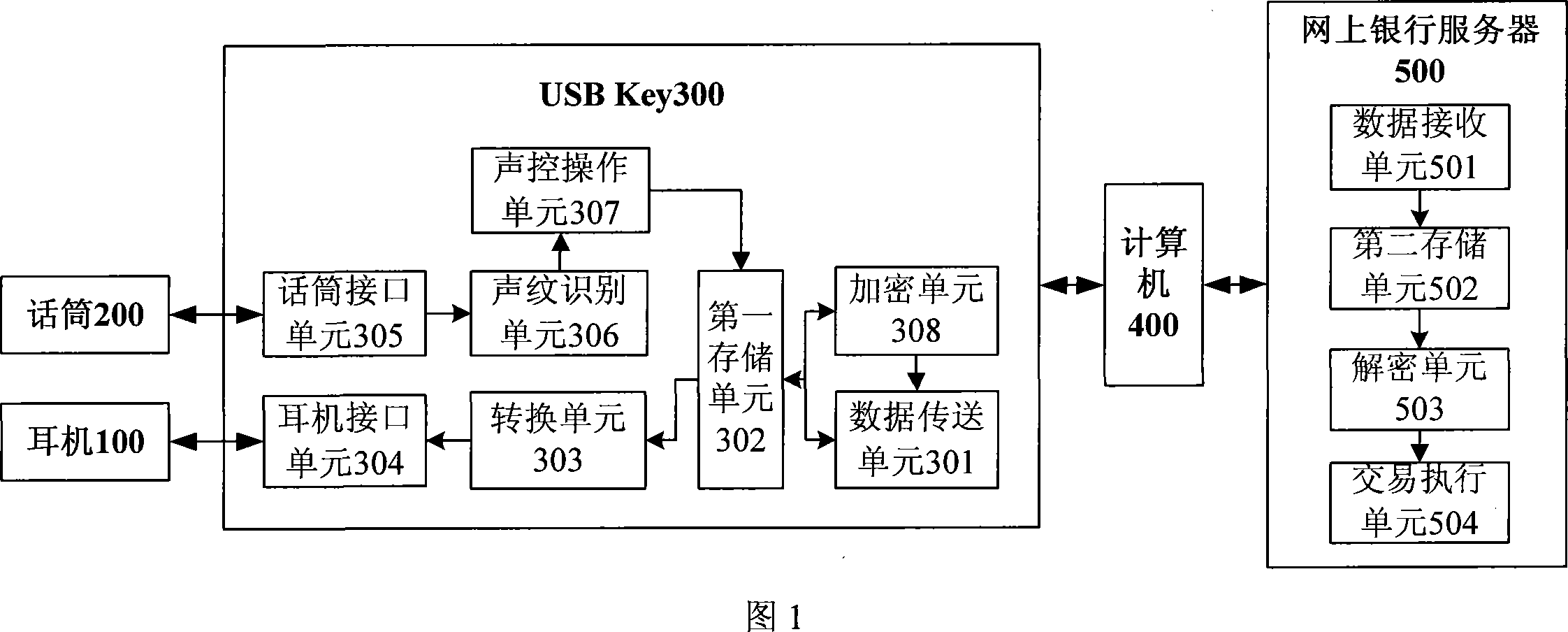

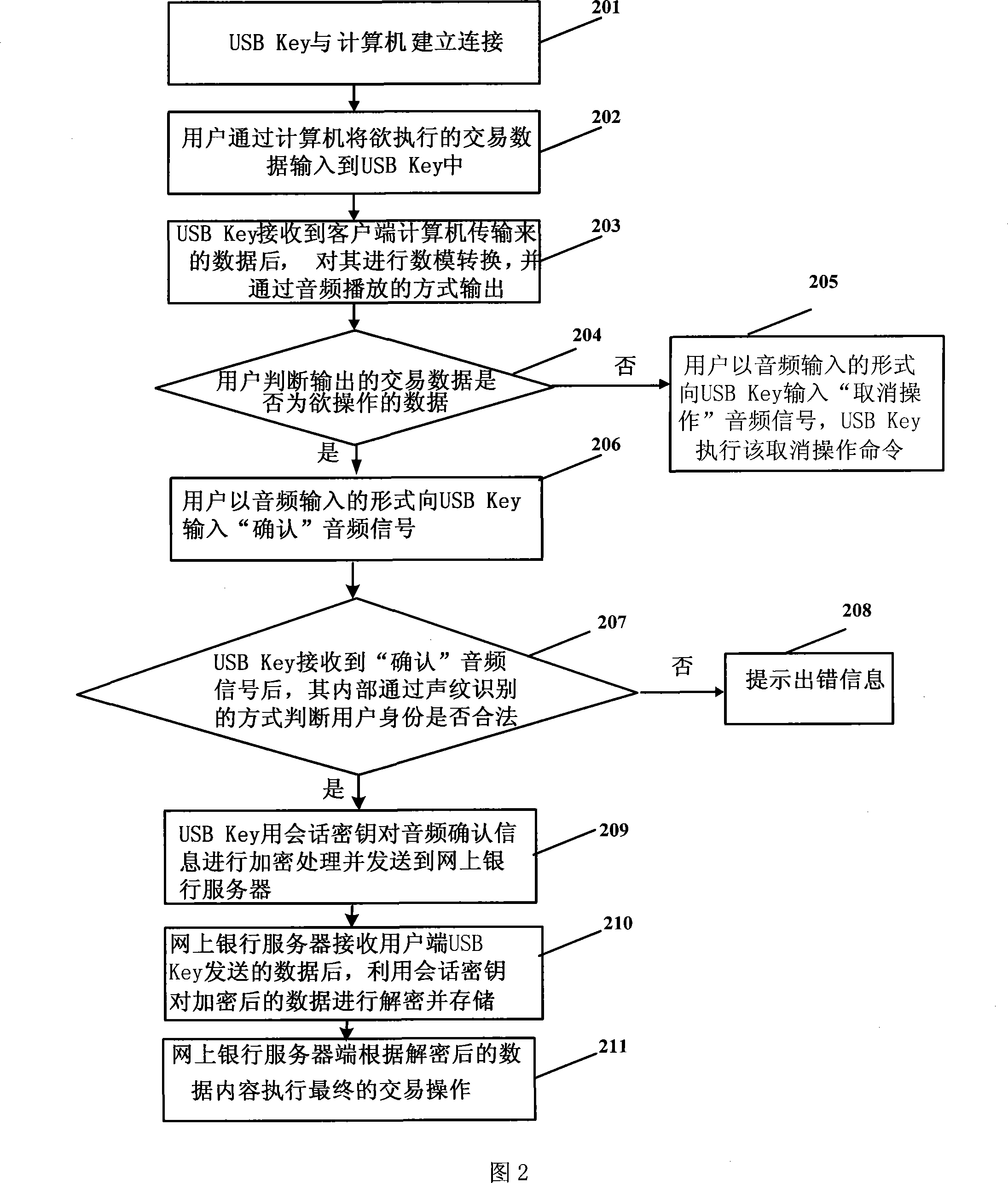

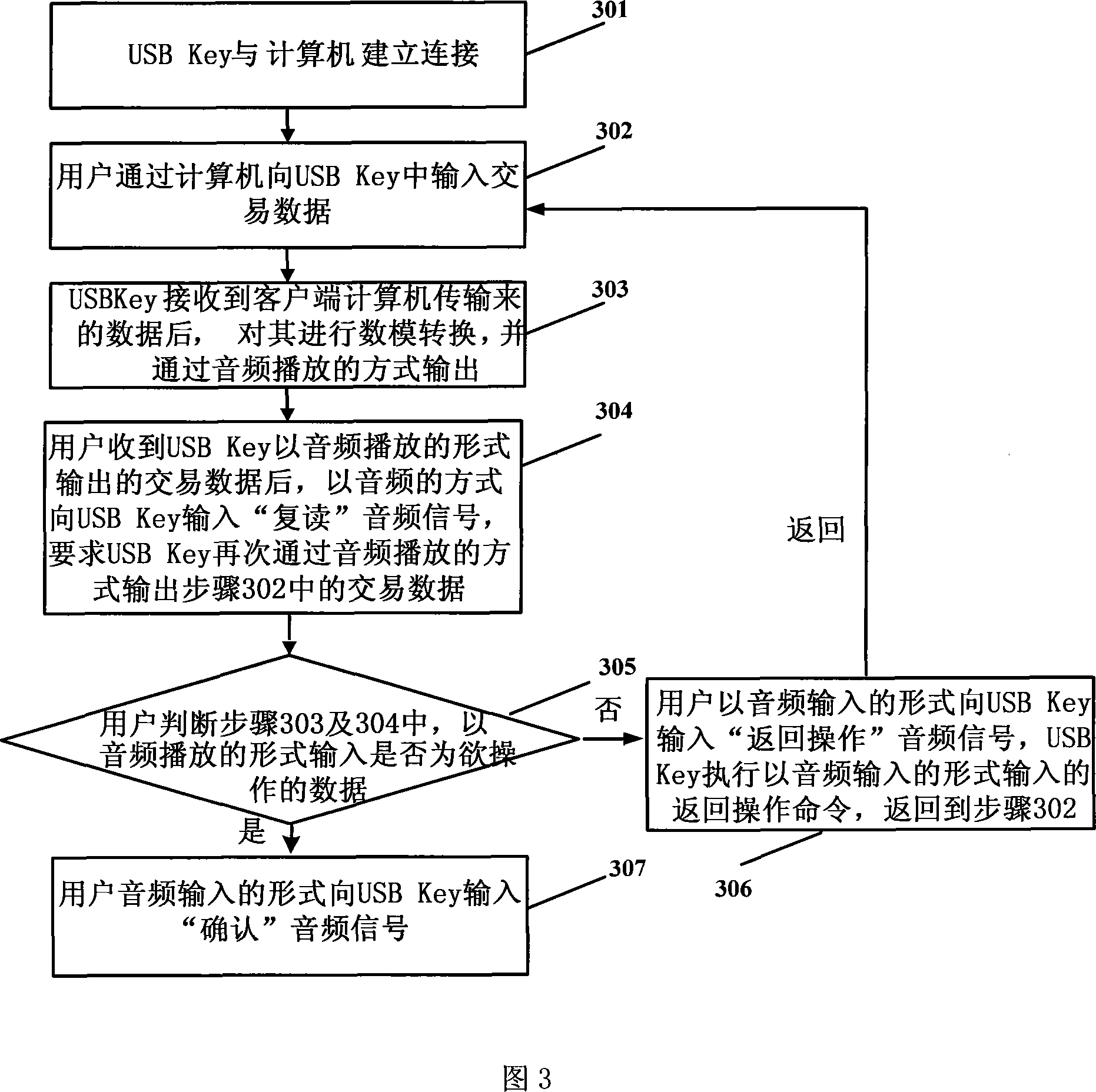

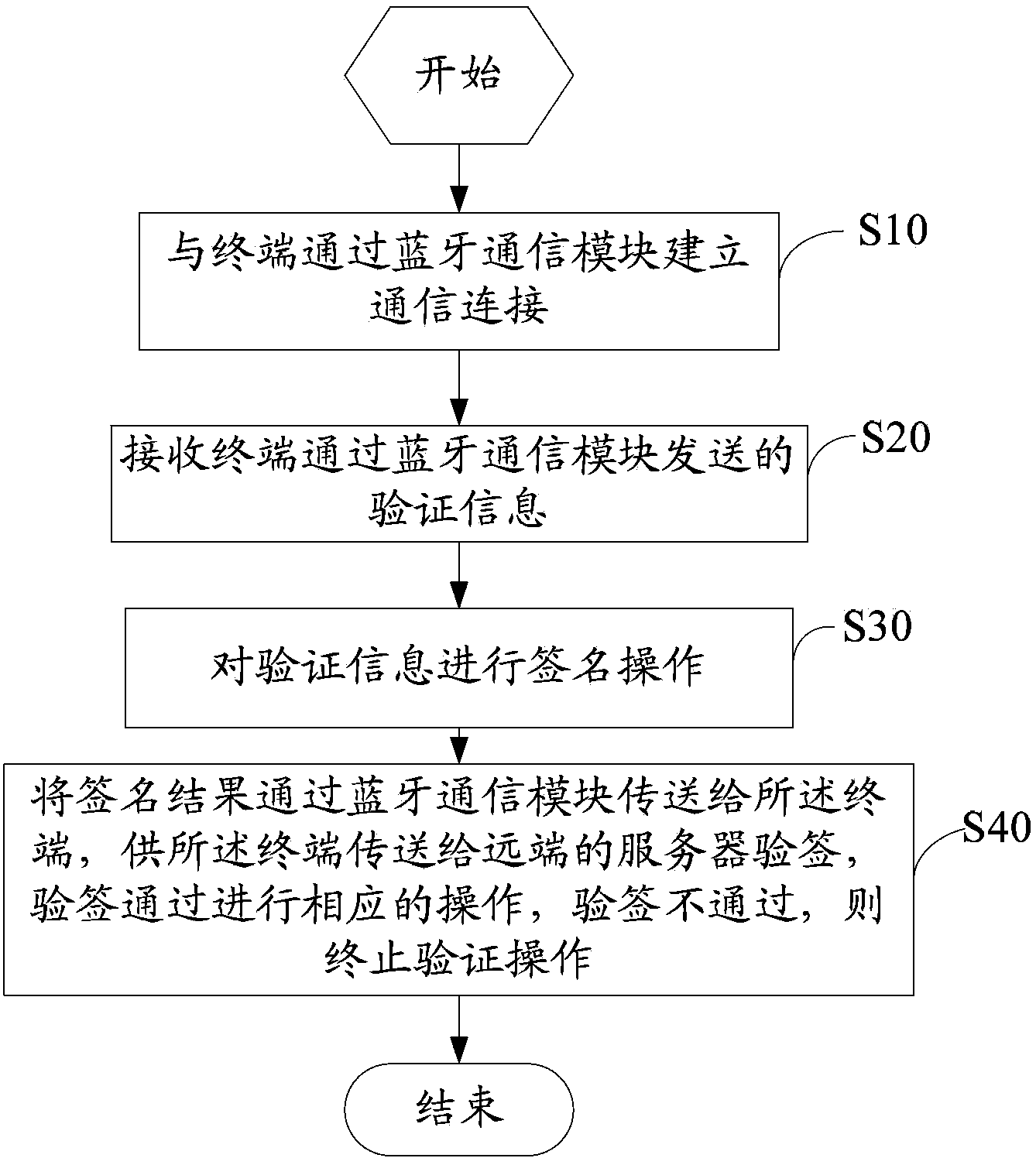

Method and system for enhancing internet bank trade security

The invention relates to the field of communication security, in particular to a system for tightening the security of on-line banking transactions and a method thereof. The system comprises a signal input and output device, a client-side information security device which supports audio processing, a computer terminal connected with an on-line bank server. The method adopted by the invention comprises the following steps: a computer is connected through the information security device; the transaction data input by a user is output in the form of audio through the information security device; an audio acknowledgement message is input to the information security device by means of audio input for voiceprint recognition; after the identity is confirmed to be legal, the client-side information security device encrypts or digitally signs all information input by users, and sends the information to the on-line bank server terminal in the form of cipher text. Certification information, as executing and confirming order, is stored in the form of audio, is unique and can not be repudiated. By adopting the method, the on-line banking transaction security can be tightened.

Owner:FEITIAN TECHNOLOGIES

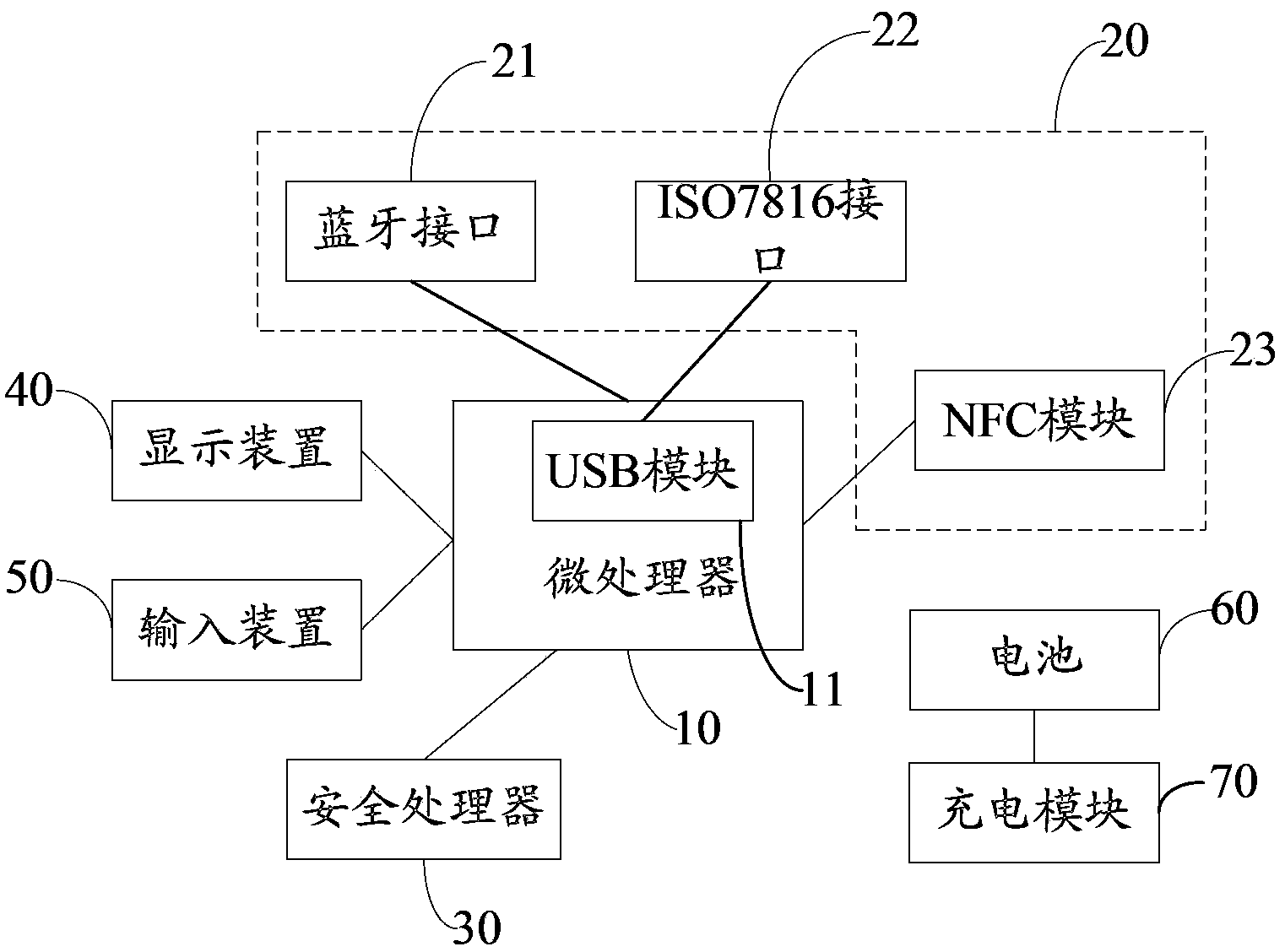

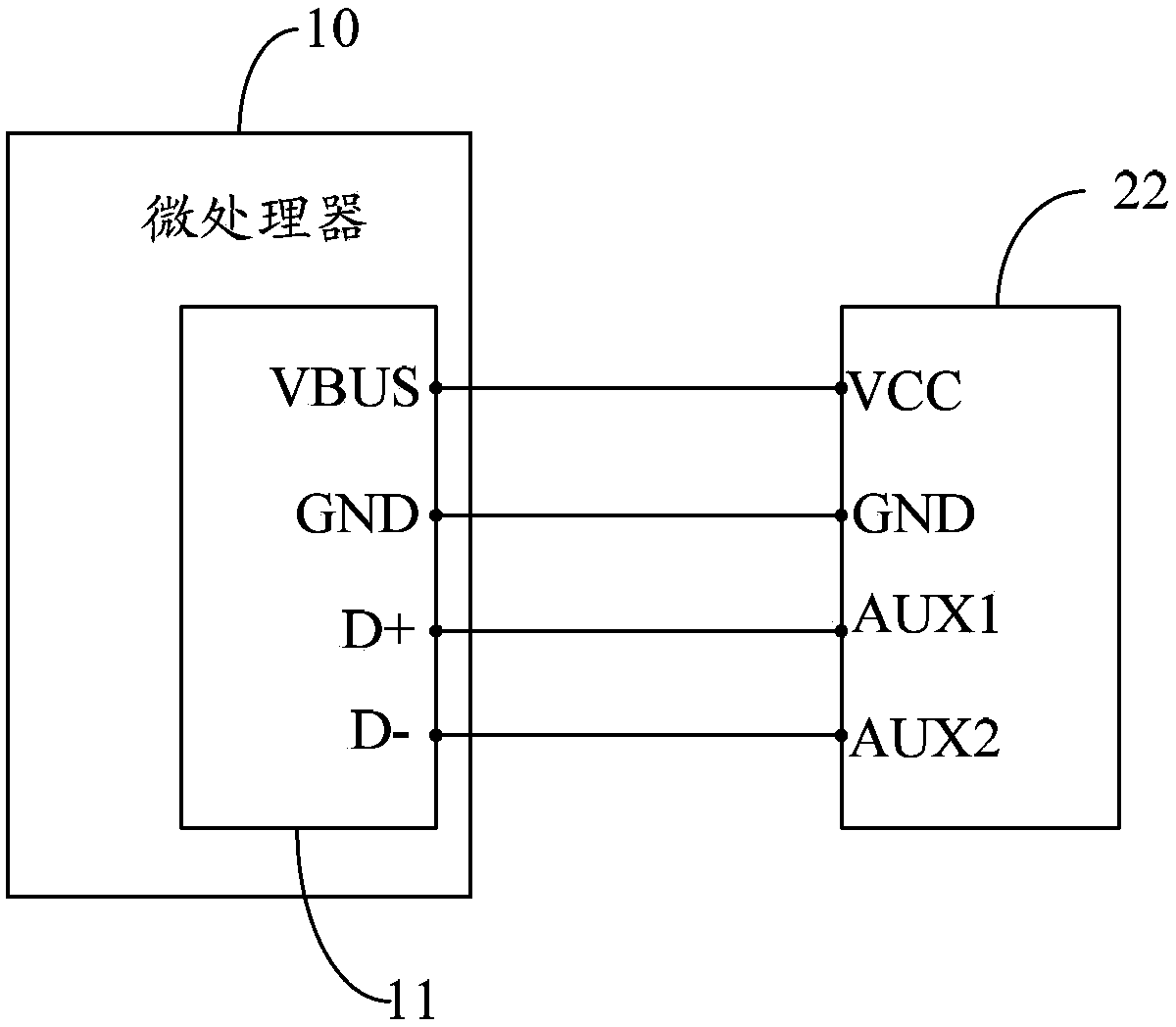

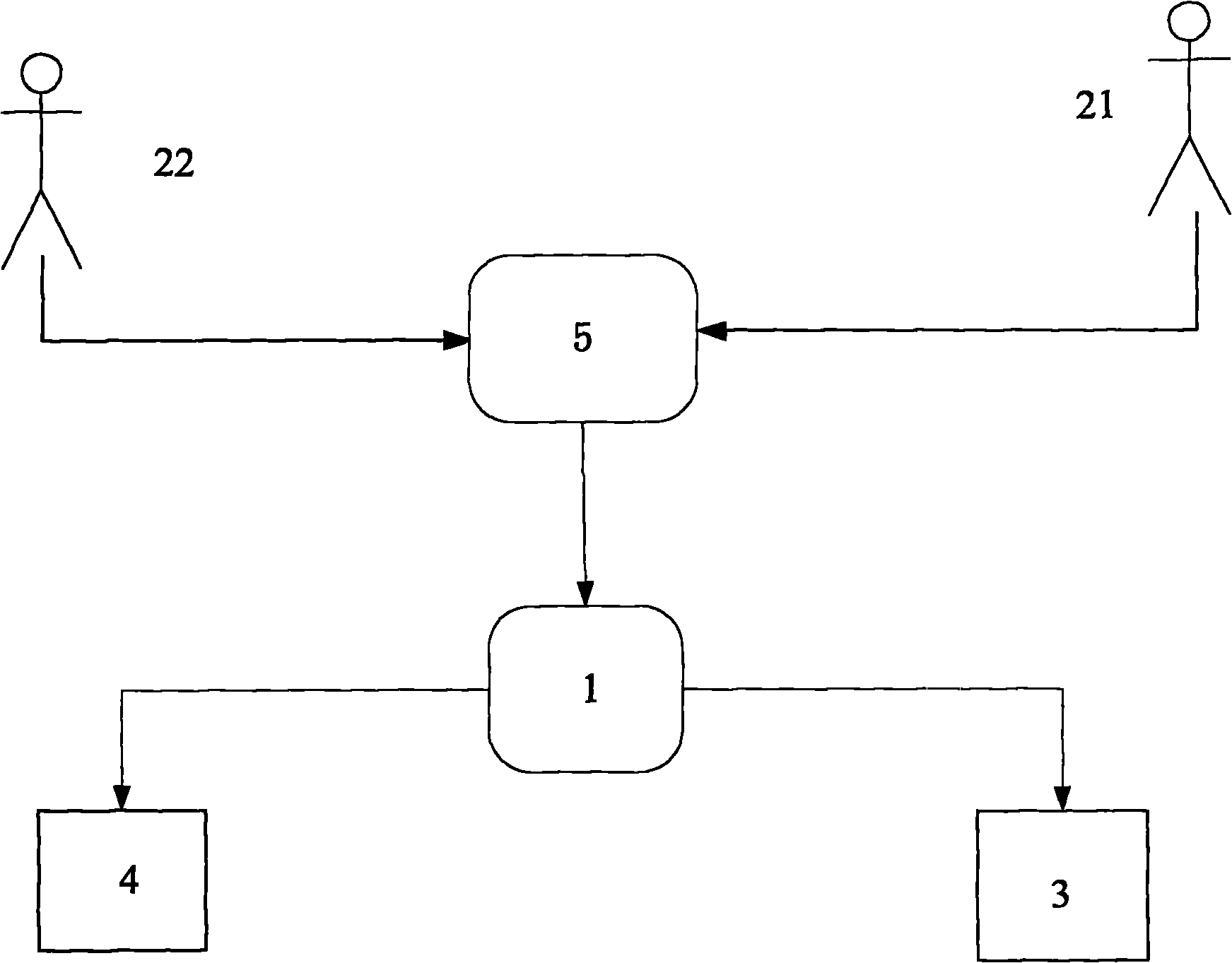

Multifunctional intelligent card and identity authentication method and operation method of multifunctional intelligent card

InactiveCN103368743AImprove securityNo misrepresentation of dataNear-field transmissionUser identity/authority verificationSmart cardWireless connectivity

The invention relates to a multifunctional intelligent card and an identification method and an operation method of the multifunctional intelligent card. The multifunctional intelligent card is connected with a client through a Bluetooth interface when internet banking transaction is carried out; since Bluetooth communication is in a one-to-one communication mode, the safety is high, and incorrect transmission of data cannot be caused, and the transaction risk is reduced; the connection is in a wireless mode, the connection is convenient, and thus the application of the multifunctional intelligent card is wider; and since a safety processor at the inner part of the multifunctional intelligent card is utilized by the multifunctional intelligent card for storing a secret key and a digital certificate, the multifunctional intelligent card not only can be used as a common card for paying at a payment terminal, but also can be used as a USBKEY for online paying, the function is diversified, and the cost is saved.

Owner:SHENZHEN EXCELSECU DATA TECH

Bank transfer method by using mobile phone

The present invention relates to a bank transfer method by using a mobile phone, comprising the steps that: (1) the payer opens a mobile phone banking service; (2) the payer logins a mobile phone banking system and selects a bank card account as transfer account; (3) the payer inputs the mobile phone number of the payee, the mobile phone banking system judges whether the mobile phone number is registered in the mobile phone banking system or not; a. if the mobile phone number is registered, the mobile phone banking system calls the payer to fill the transfer information and completes the transfer if the information is legal; b. if the mobile phone number is not registered, the mobile phone banking system sends a push short message to the payee through an interface provided by a short message service center, the push short message includes an link, the payee gets the relevant page through the link and completes the transfer if the information is right. Compared with the traditional bank transfer and internet bank transfer, the invention has the advantages of better interactivity between the mobile phone and the computer network of a bank, rapid data transmission, available use, convenience, safety and reliability.

Owner:CHINA EVERBRIGHT BANK

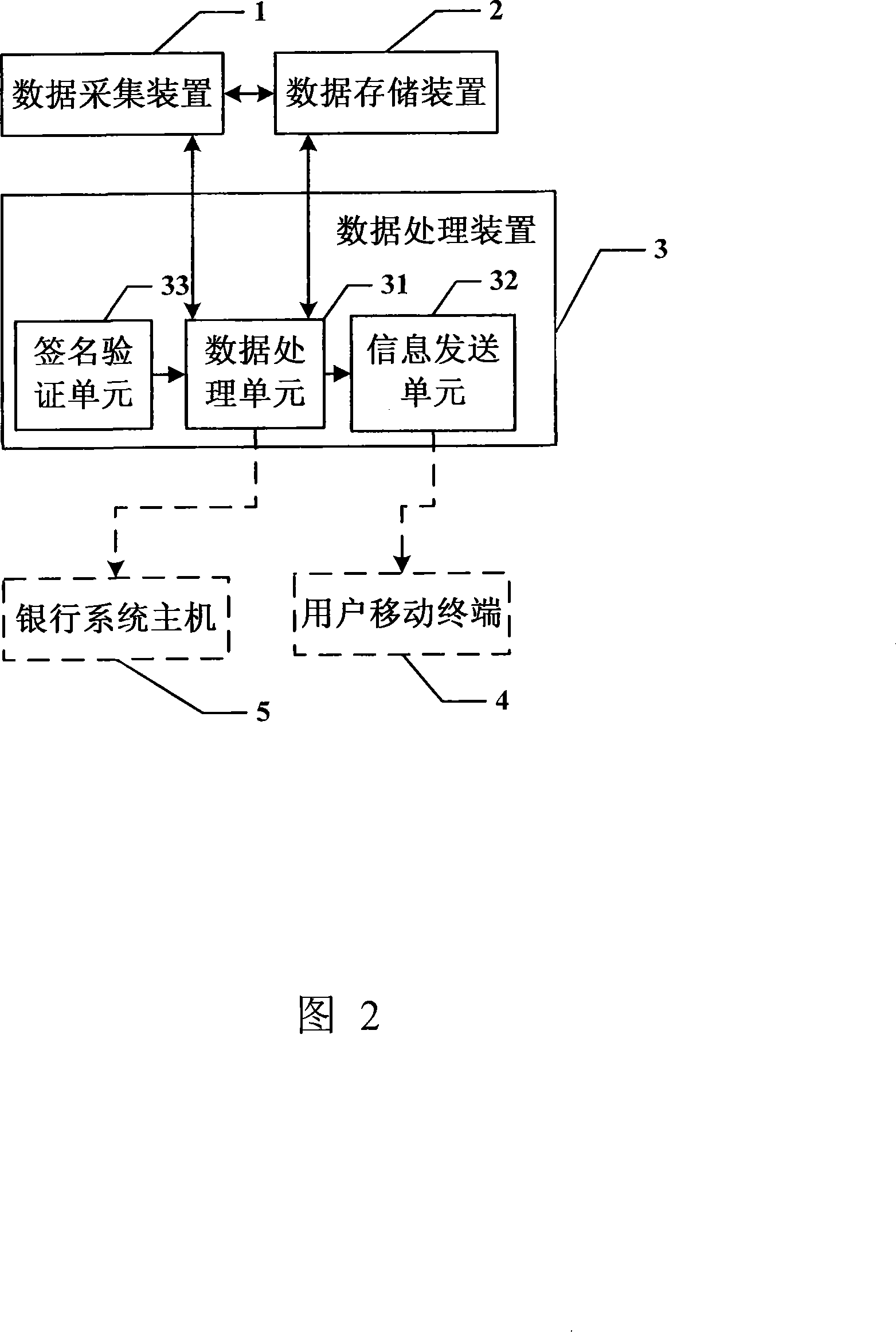

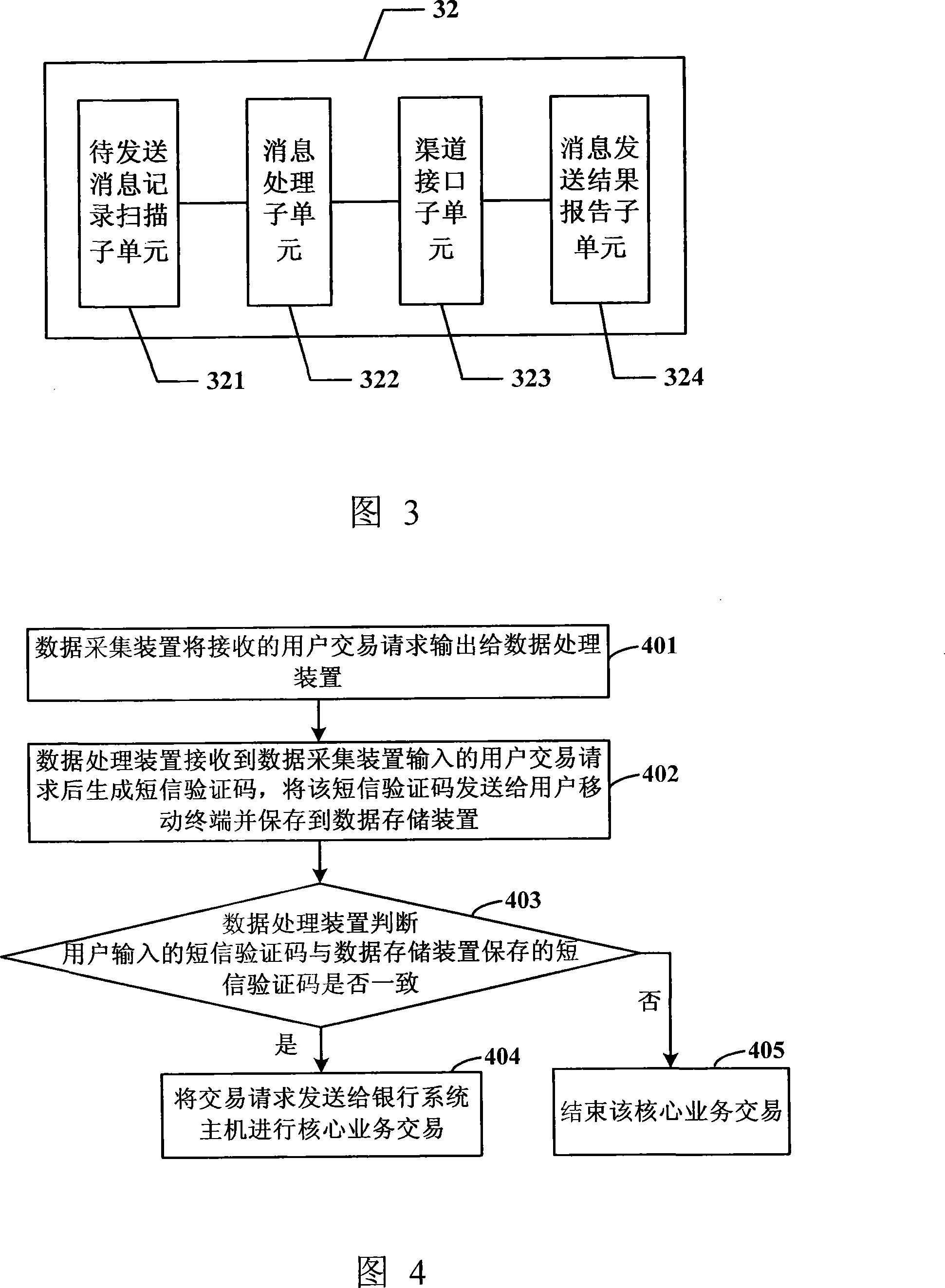

A system and method to enhance the data security of e-bank dealings

InactiveCN101216923AImprove securitySolve the problem of remote control to steal user fundsFinanceUser identity/authority verificationData acquisitionData store

The invention discloses a system for improving security of network bank transaction data. The system includes a data acquiring device for receiving transaction data input by a client, outputting the received transaction data to a data processing device, and storing the data in a data storing device; the data storing device for storing the transaction data input by the data acquiring device and the data input by the data processing device; and the data processing device for generating massage identifying code after receiving a request for user transaction, and sending the generated massage identifying code to a user mobile terminal and storing the code in the data storing device, wherein, after the massage identifying code input by the user is received, whether the massage identifying code is accordant with the massage identifying code stored in the data storing device is judged; and if the result is positive, the transaction request is sent to a bank system mainframe to carry out core business transaction, otherwise, the process is over. A method for improving security of network bank transaction data is also provided. The invention improves security of network bank transaction data.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

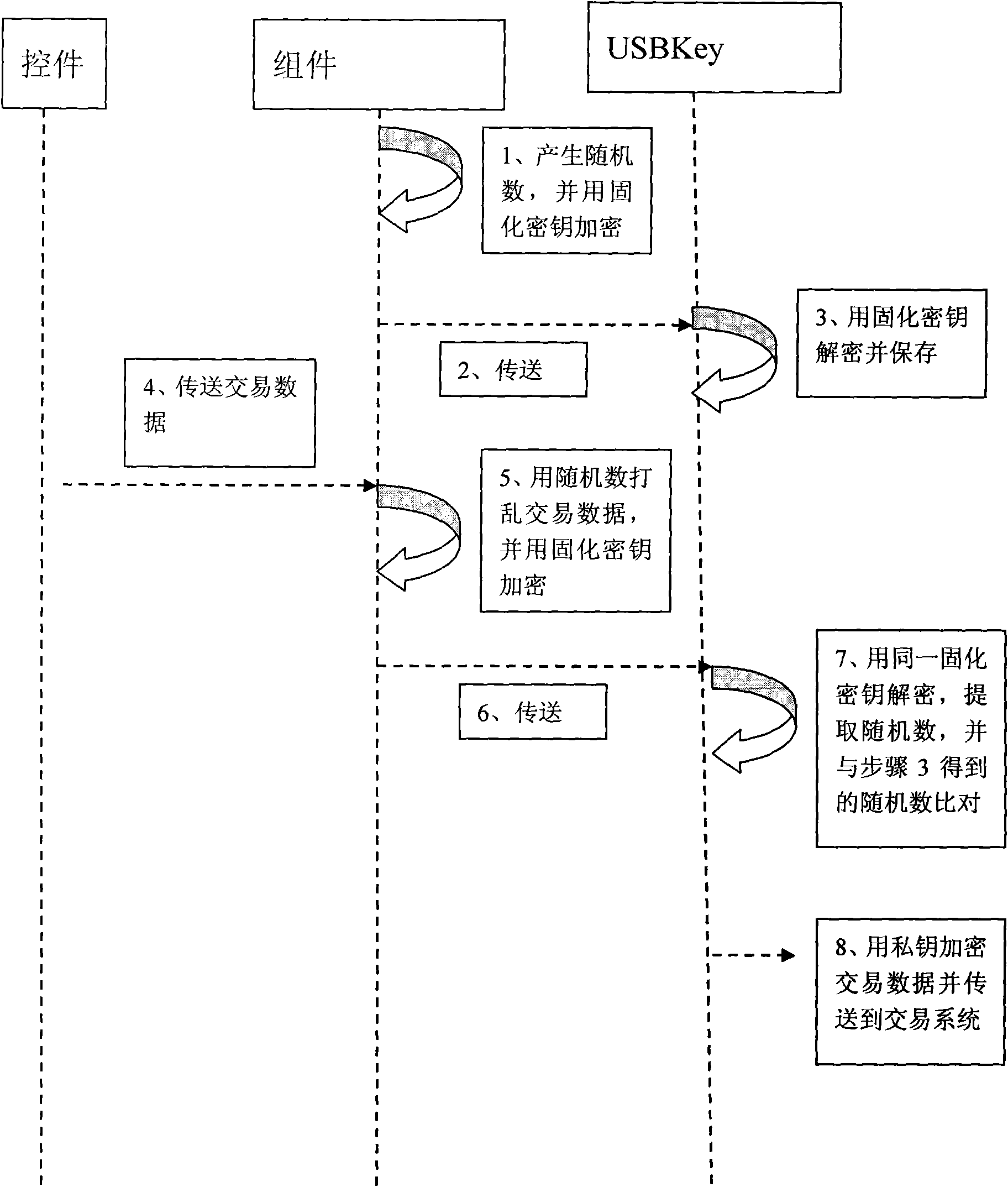

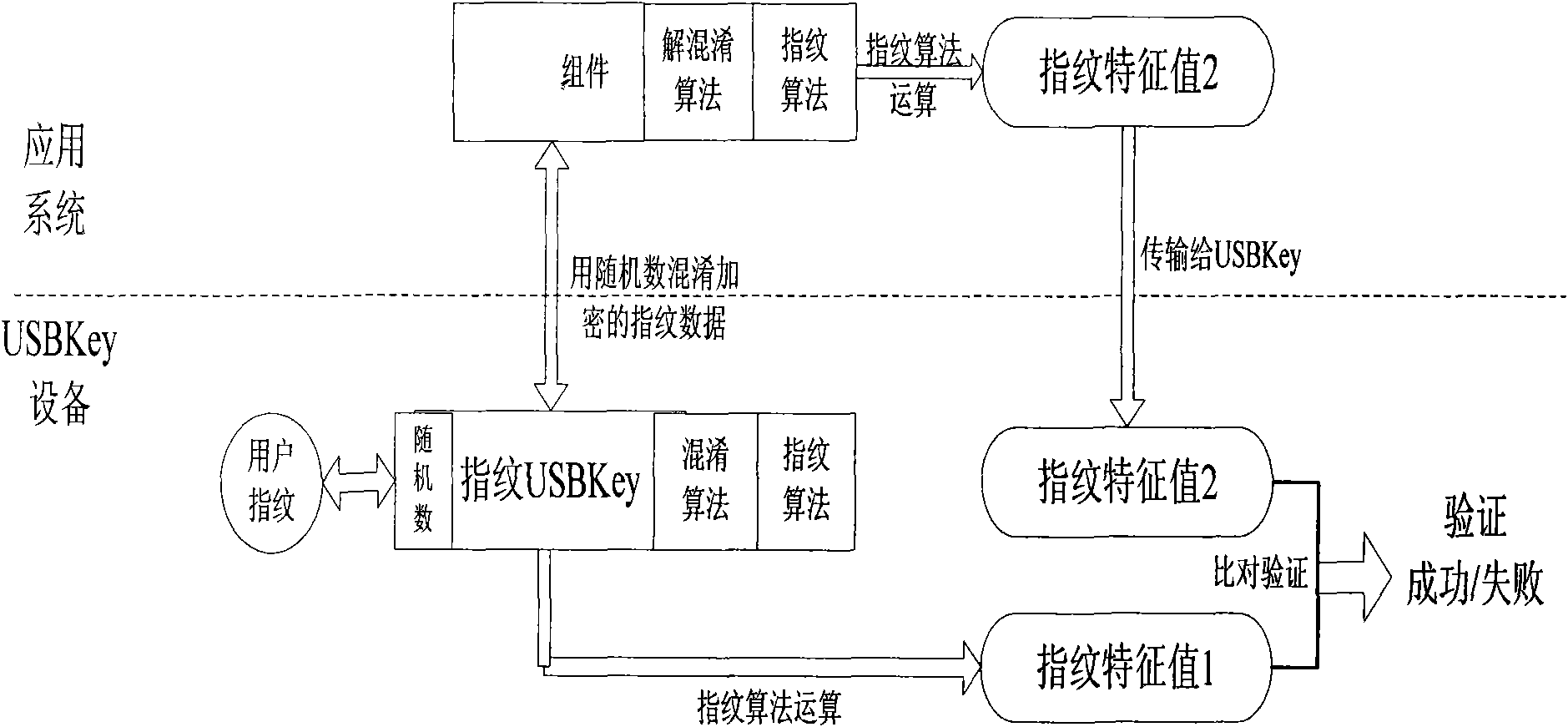

Method and system based on USBKey online banking trade information authentication

The invention discloses a method based on USBKey online banking trade information authentication; when being used for the first time, system software is automatically mounted into an operating systemand a solidifying key is mounted simultaneously; when a user finishes pressing a trade fingerprint to confirm the trade, application software generates a random number and uses the solidifying key toencrypt and transmit to a USBKey; meanwhile, the application software uses the random number to implement inserting and upsetting on the received trade data and uses the solidifying key to encrypt andtransmit to the USBKey; the USBKey uses the shared solidifying key to decrypt to obtain one random number and a string of trade data upset by the random number, uses the shared key to take out the random number inserted into the trade data and compares the random number with the random number obtained by directly deciphering, and the random number is confirmed to be true and valid if the resultsare the same. The invention can guarantee the trade information to be safely transferred in the network links by establishing a data truth authentication system, stop the trade information from beingmaliciously altered and protect the user trade to be safely and validly executed.

Owner:ZHEJIANG WELLCOM TECH

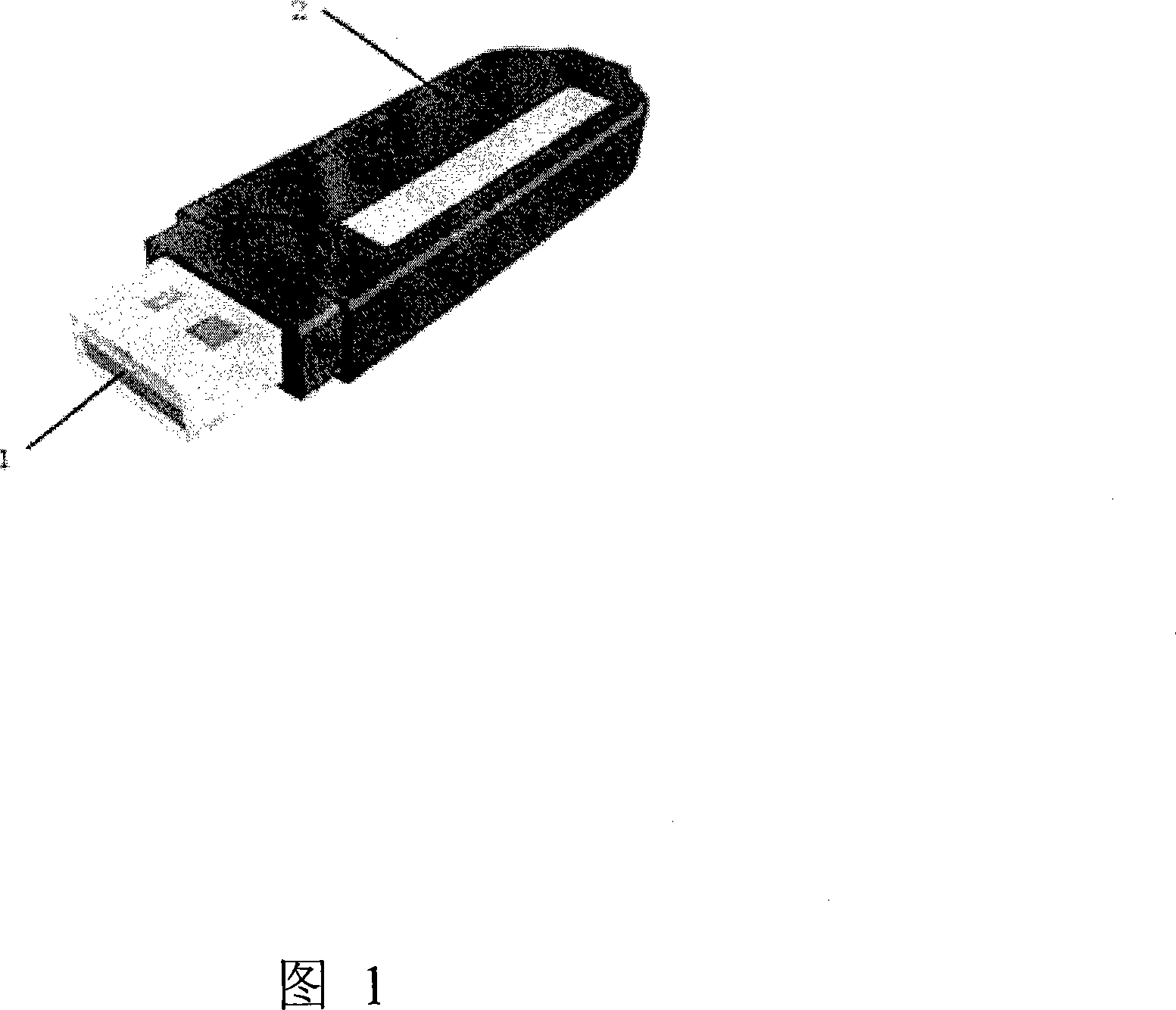

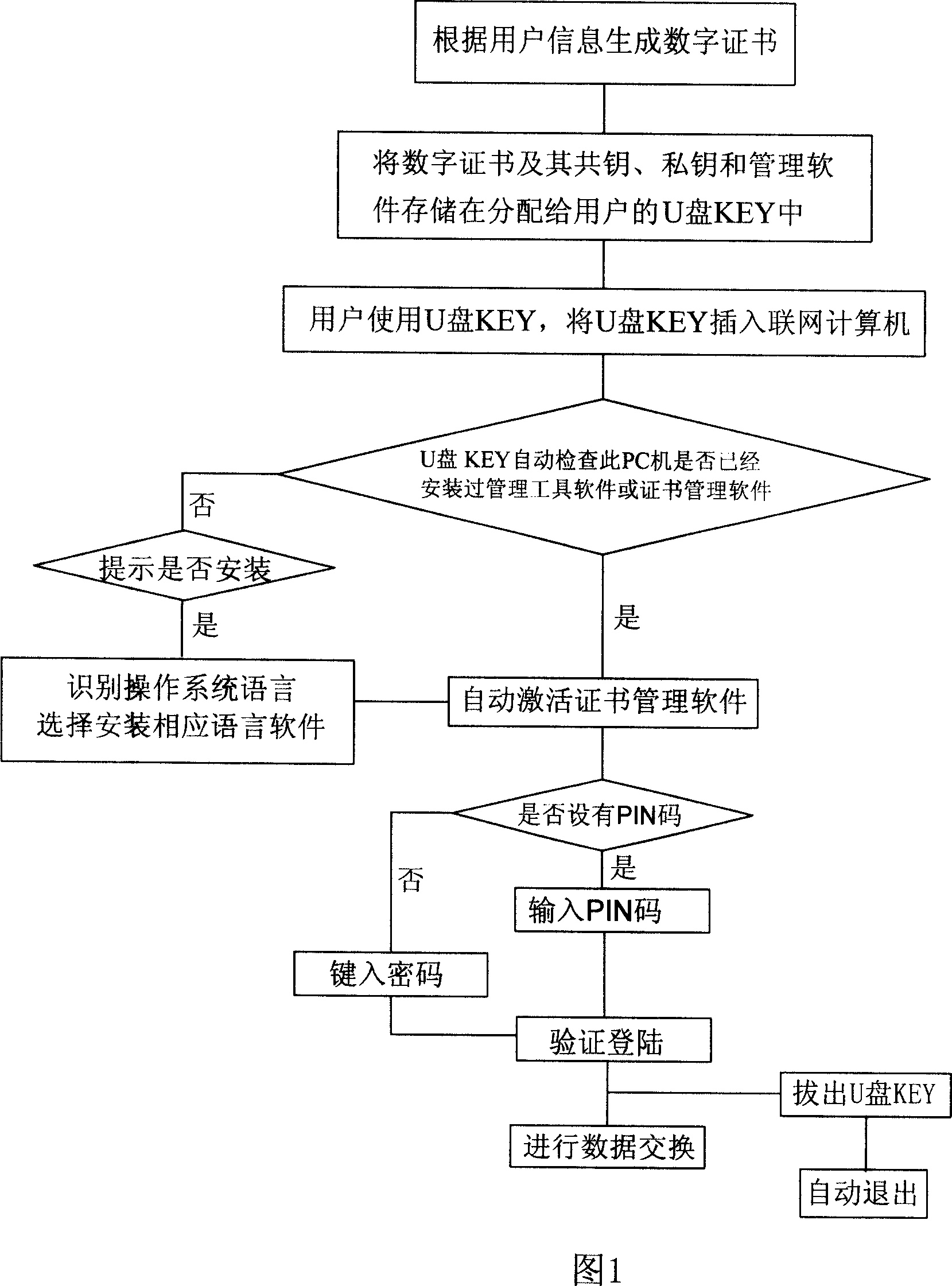

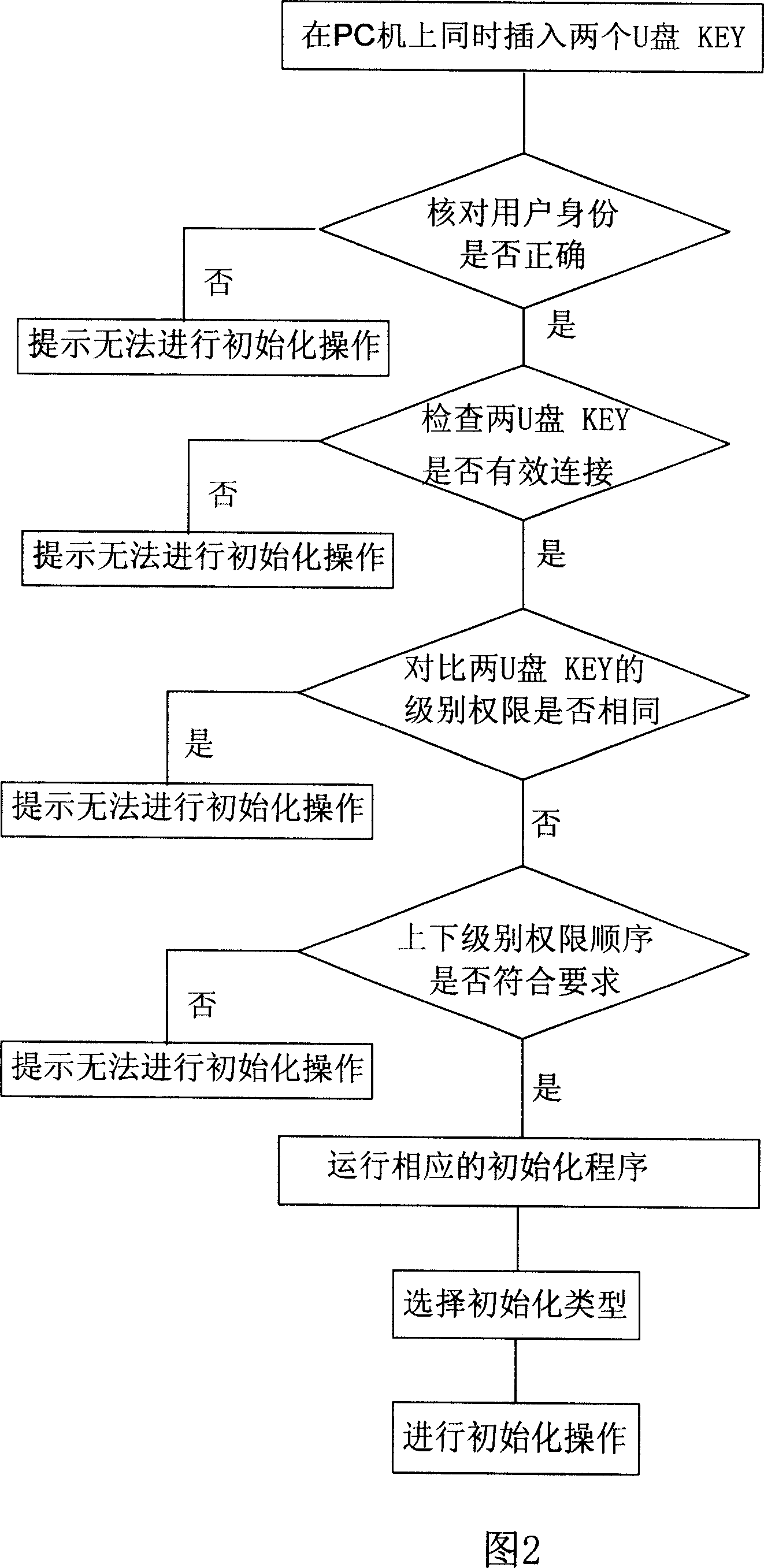

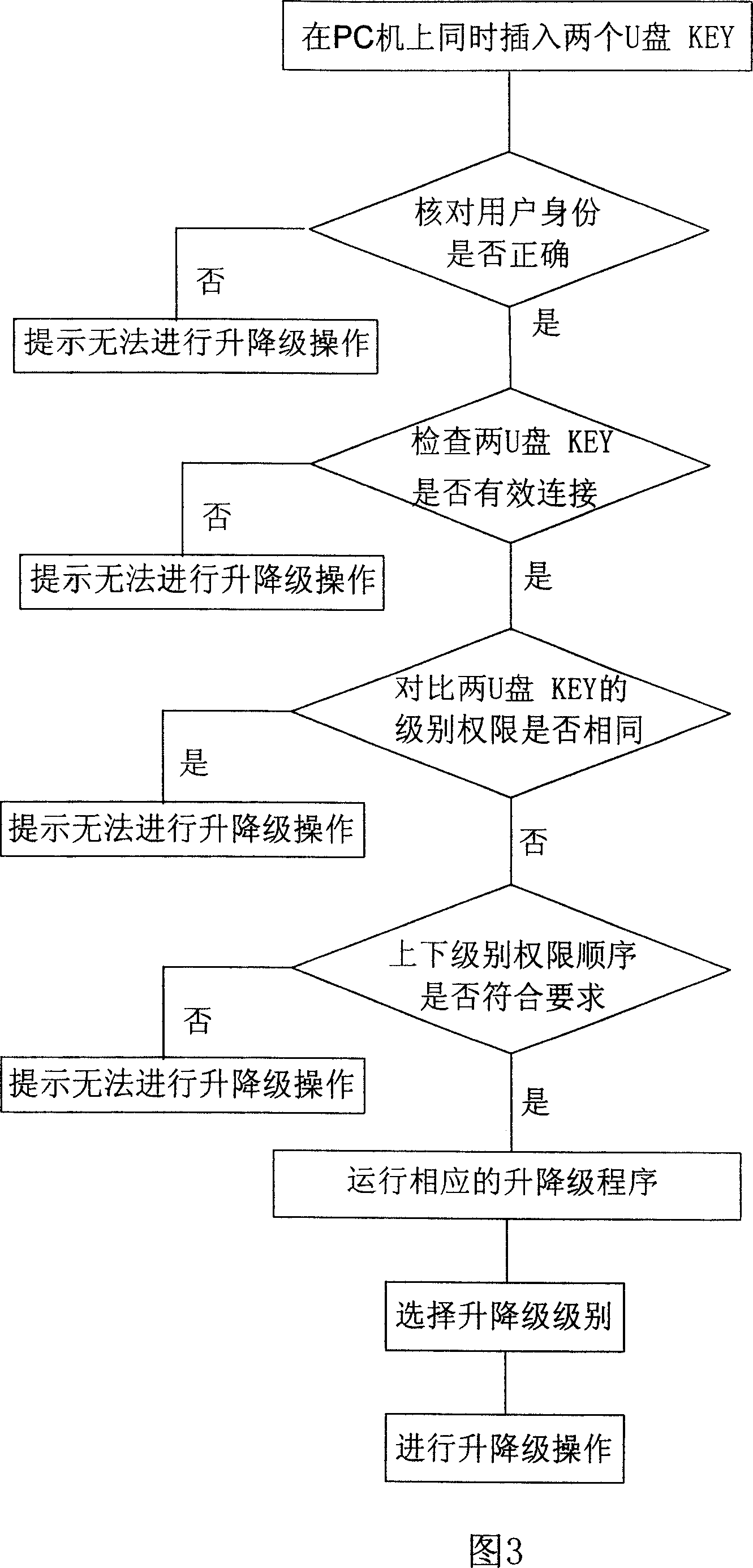

Internet bank U disc KEY ciphering, authentication device and method

InactiveCN101127111AAvoid the risk of forgetting to log out of the systemWith U disk storage functionFinanceDigital data protectionSoftware engineeringUSB

The utility model discloses an encryption and authentication method for U disk KEYS used at the internet banking, which comprising following steps: 1) a digital certificate is generated according to the information of the users; 2) the generated digital certificate in the first step and a public key, together with a private key, and a management software are stored in the U disk KEY allocated to the users; 3) when used, data processing at the internet banking is done after the users are identified with the U disk KEY. The utility model also discloses an encryption and authentication apparatus for the U disk KEY at the internet banking, mainly comprising a U disk KEY, a mainframe, a networked computer and an application server. Through the utility model, the ordinary USB KEY and the U disk memory chip are organically integrated as a whole which has a memory function of the U disk; the necessary management software for the use of the USB KEY and other programs are stored and used as a whole, and the process of the software installation is rapid and simple just by maintaining the necessary selection procedures in the installation process of the users, moreover, coding rules for passwords are not constrained and the ways for certificates management are more reasonable and easy to be operated.

Owner:CHINA CITIC BANK

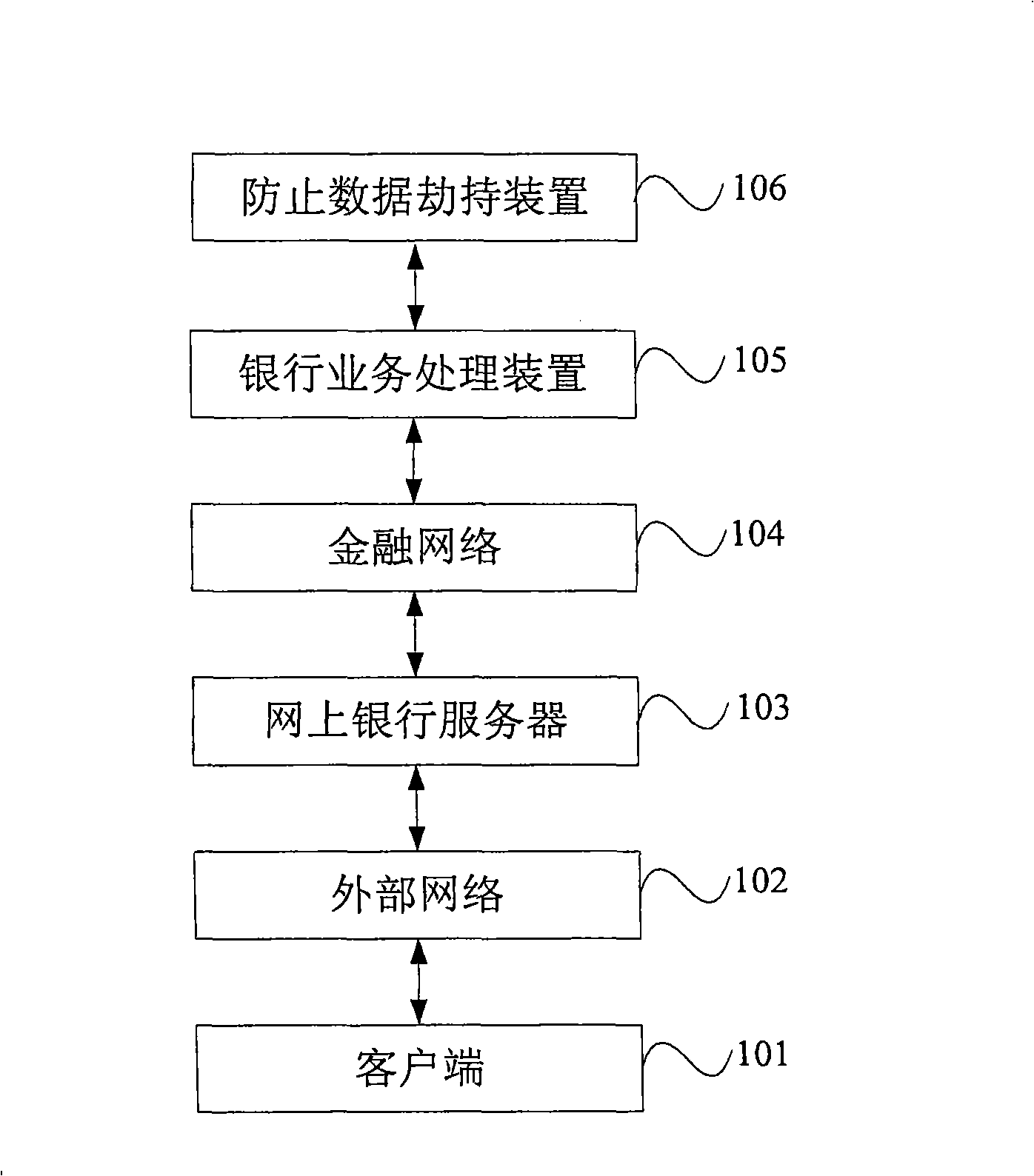

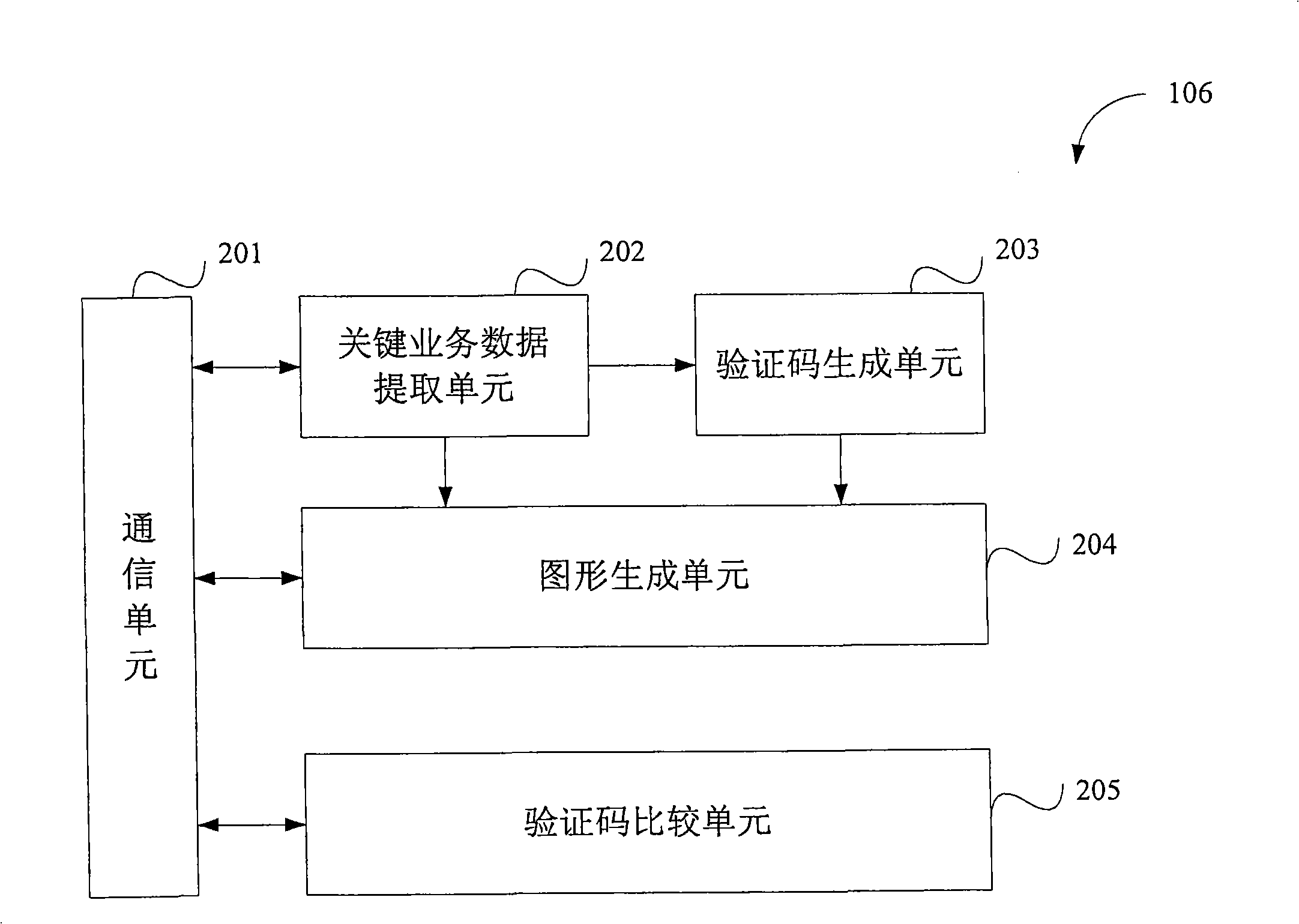

A method, device and system for preventing network bank from hijacking data

ActiveCN101267311AImprove securityView data consistencyFinanceUser identity/authority verificationGraphicsUser input

The invention provides a method, a device and a system for preventing data in an Internet bank from hijacking, the method comprises the steps of: receiving a bank service request and extracting the key service data in the bank service request; generating a random verification code for the key service data; generating a figure which displays the key service data and the random verification code; sending the figure to users and receiving the verification codes input by the users; judging whether the received verification code is as the same as the random verification code contained in the sent figure, if so, performing the sequent bank service processing, if not, terminating the bank service. The technical proposal of the invention adopts the figure technology to protect the important data information of users from juggling, enhancing the security of trade information at the client.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

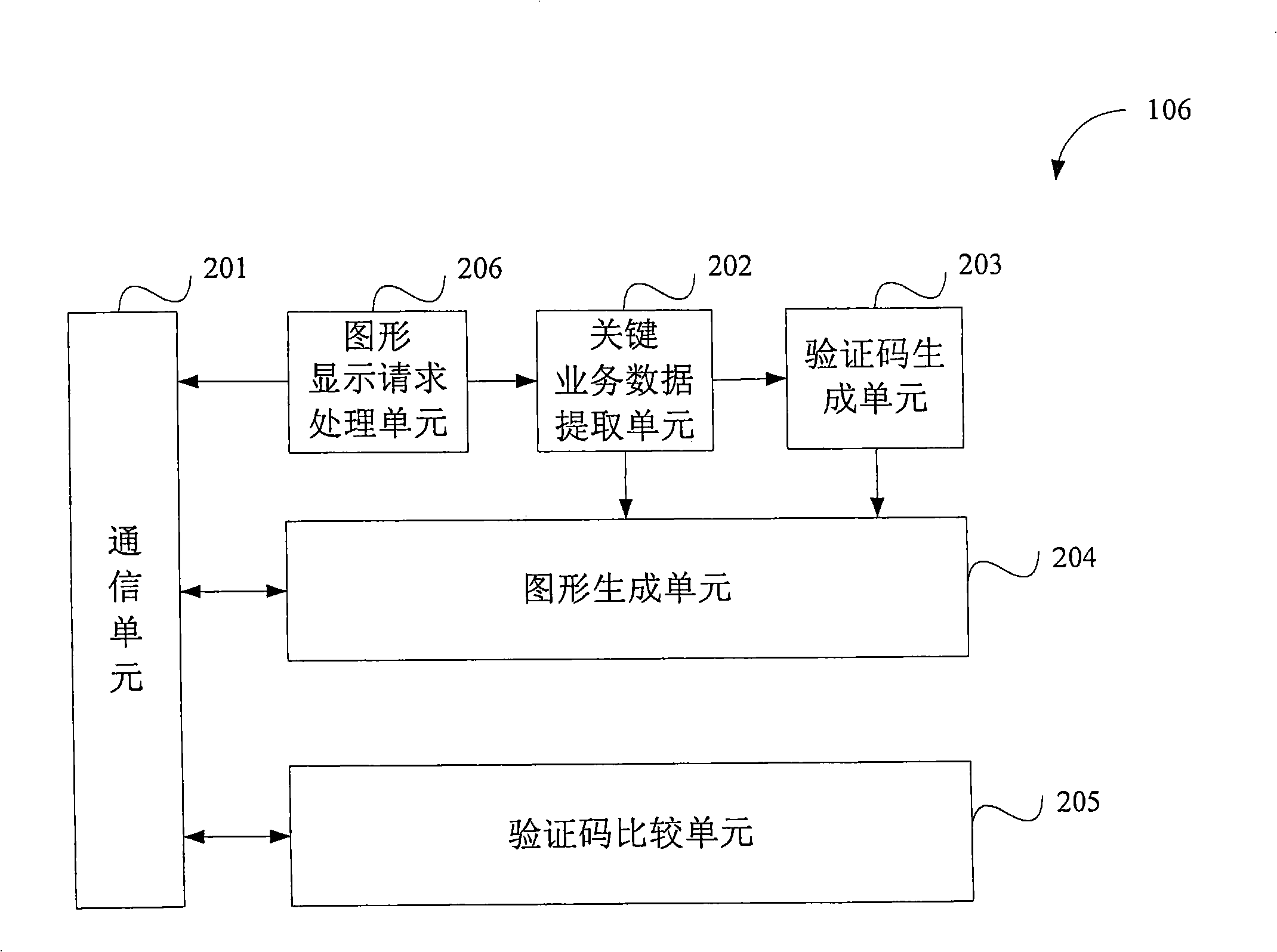

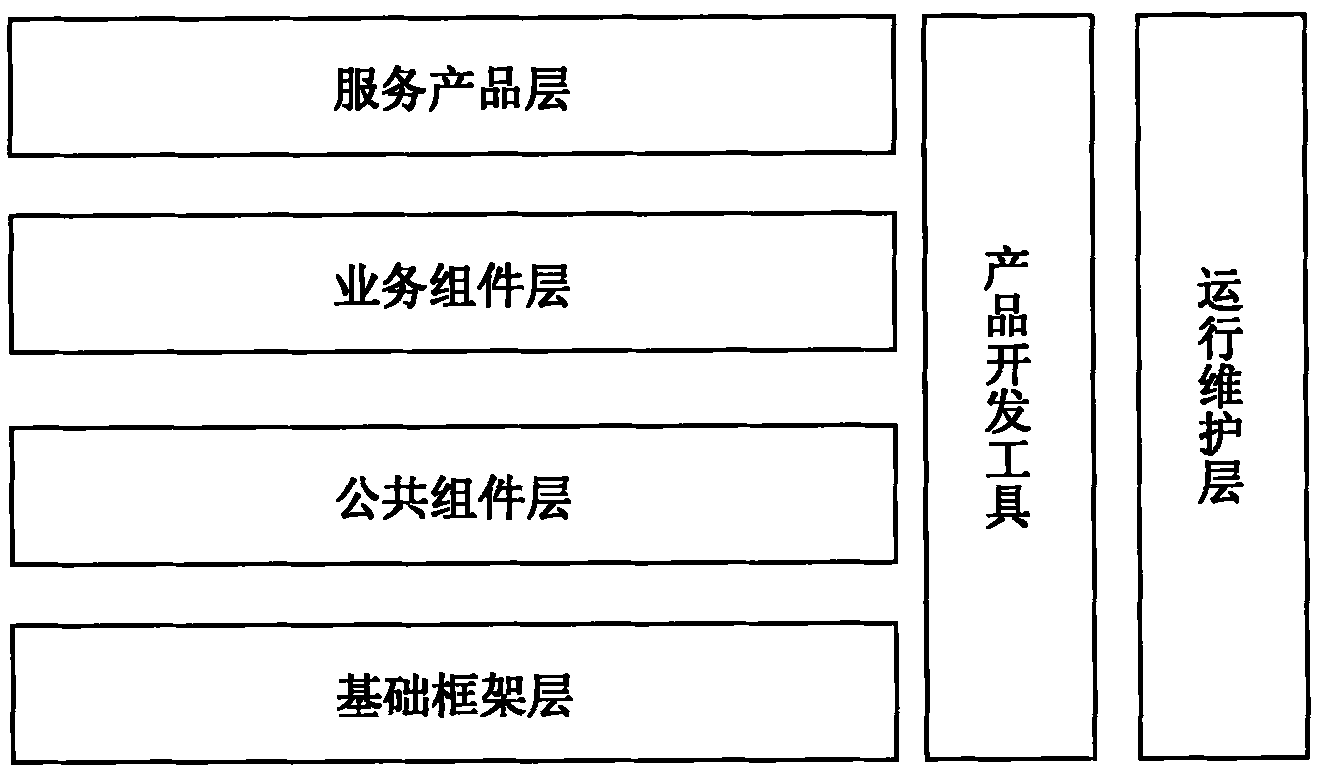

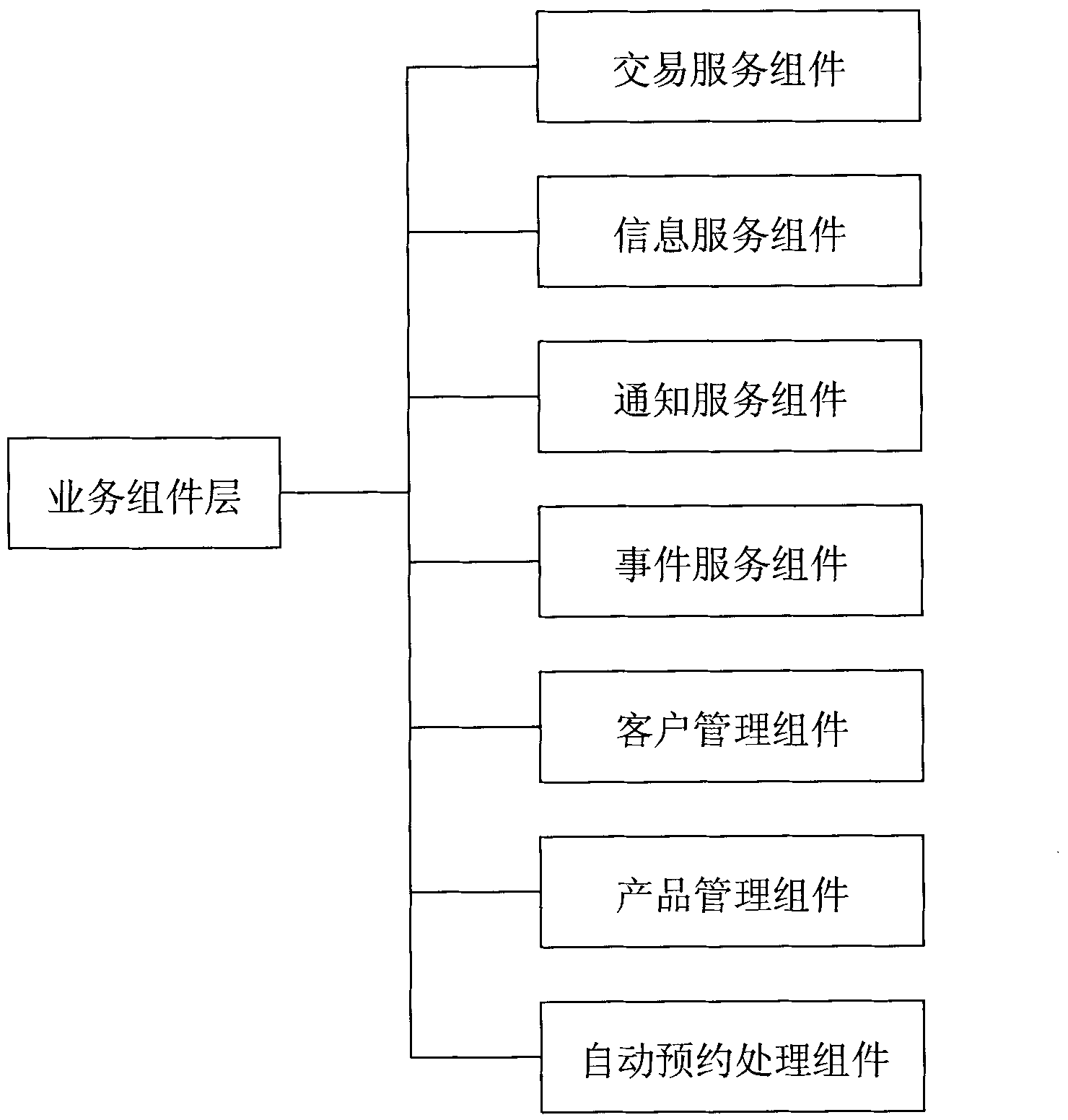

Internet banking business platform and operation method thereof

InactiveCN101877111AEmbody the idea of integrated customer serviceAdapt to service needsFinanceEngineeringApplication software

The invention provides an internet banking business platform, comprising a basic framework layer, a common assembly layer, a business assembly layer, a service product layer, an operation maintenance layer and a product development tool, wherein the basic framework layer is used for providing a basic operation environment for the internet banking business platform; the common assembly layer is used for providing common assemblies and application program commonly used by general systems for the internet banking business platform; the business assembly layer is used for providing basic modules required by specific business products of internet banking; the service product layer is used for providing customer-oriented final business varieties; the operation maintenance layer is used for providing tools capable of ensuring system normal operation; and the product development tool is used for displaying patterned view product development tools in a system operation environment for application developers. The invention has the beneficial effects of reflecting the thinking of integrative customer service of banks, adapting to various customer business requirements, and enabling the banks to rapidly build an internet banking service platform and activate online service according to own business requirements.

Owner:苏州德融嘉信信用管理技术股份有限公司

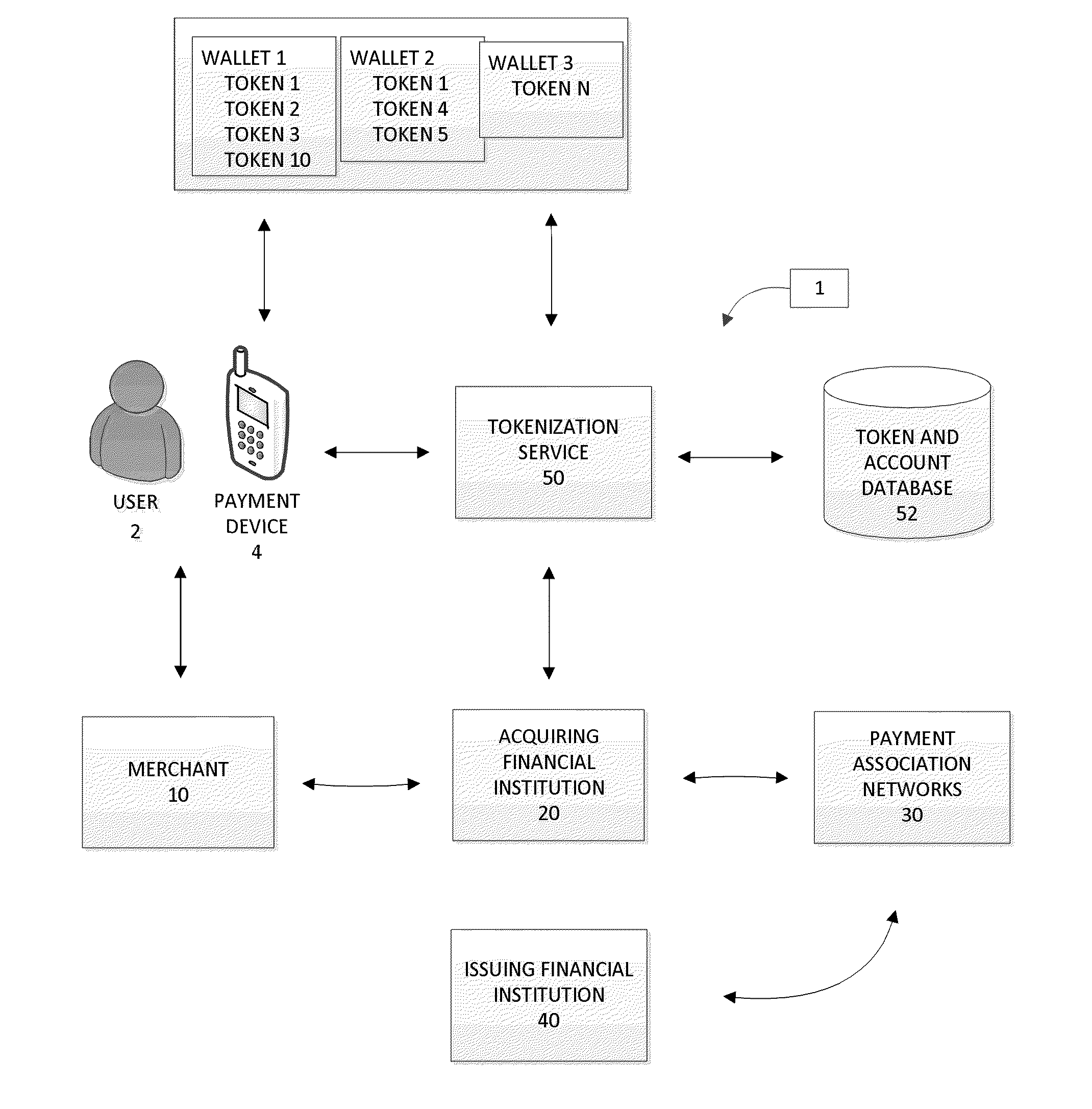

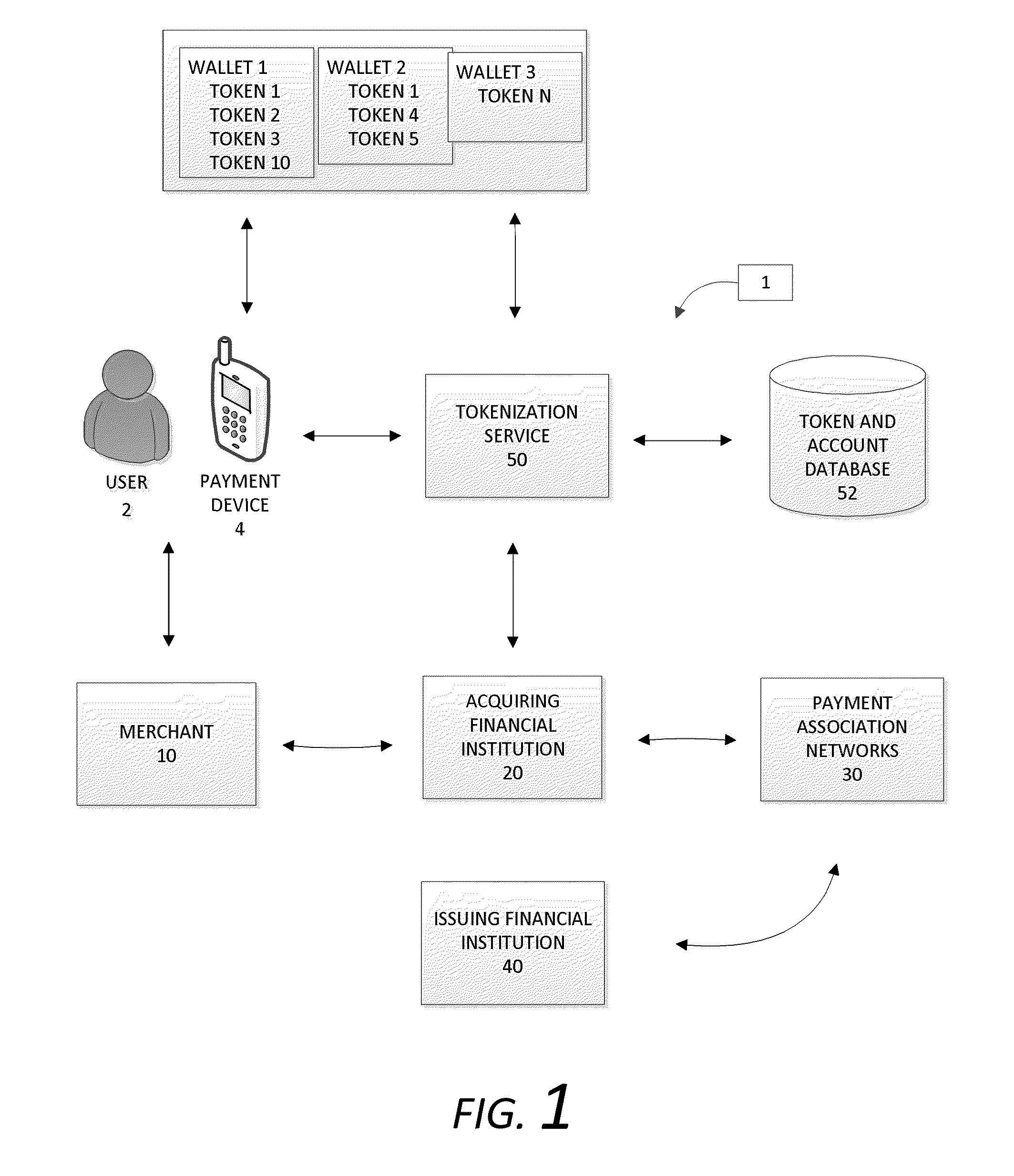

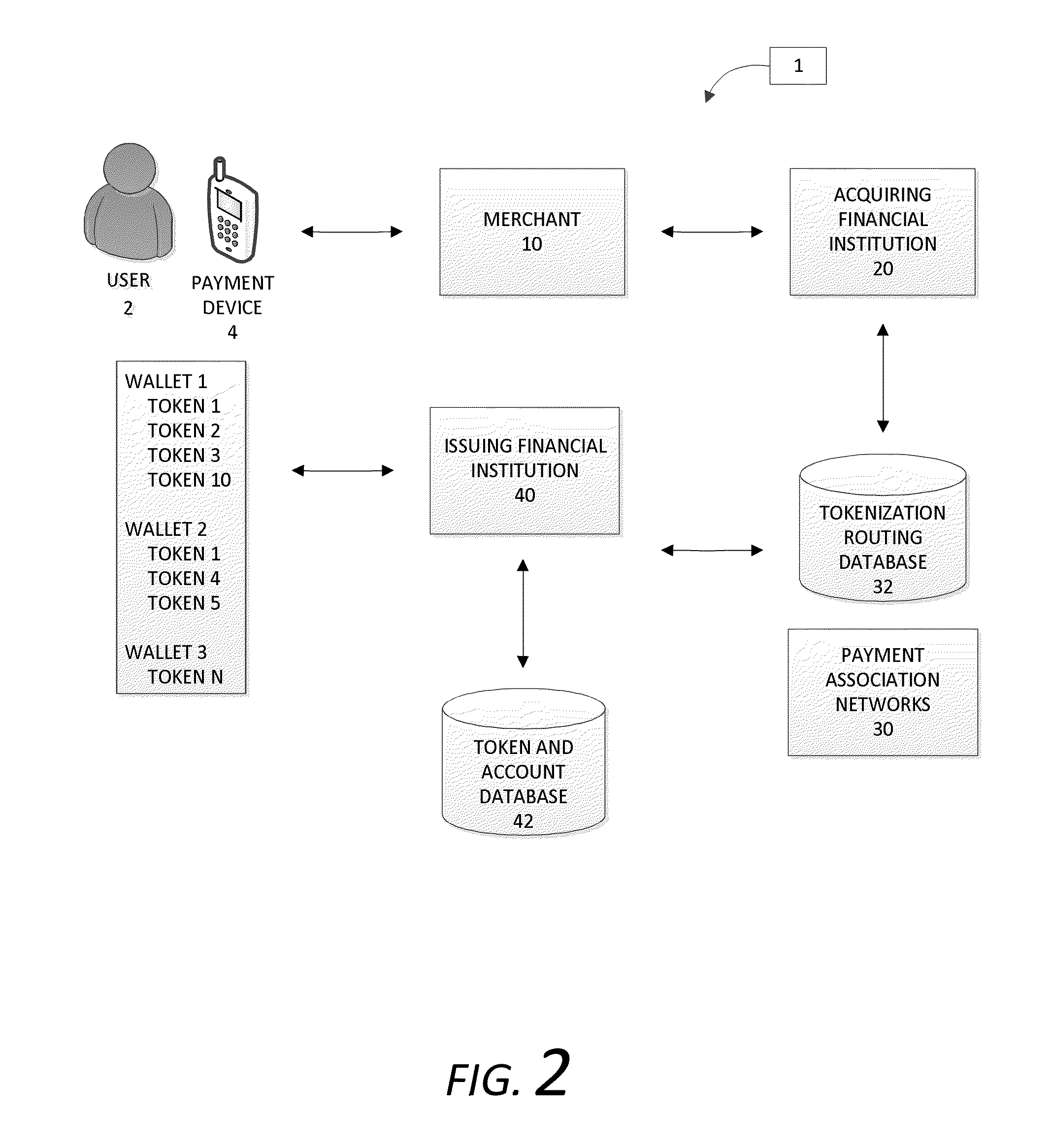

Online banking digital wallet management

Embodiments are directed to digital wallet management. Embodiments initiate presentation of a digital wallet management interface, comprising initiating presentation of at least one digital wallet; and initiating presentation of at least one representation of at least one payment credential and at least one indication of which of the at least one digital wallets are associated with each of the at least one payment credentials.

Owner:BANK OF AMERICA CORP

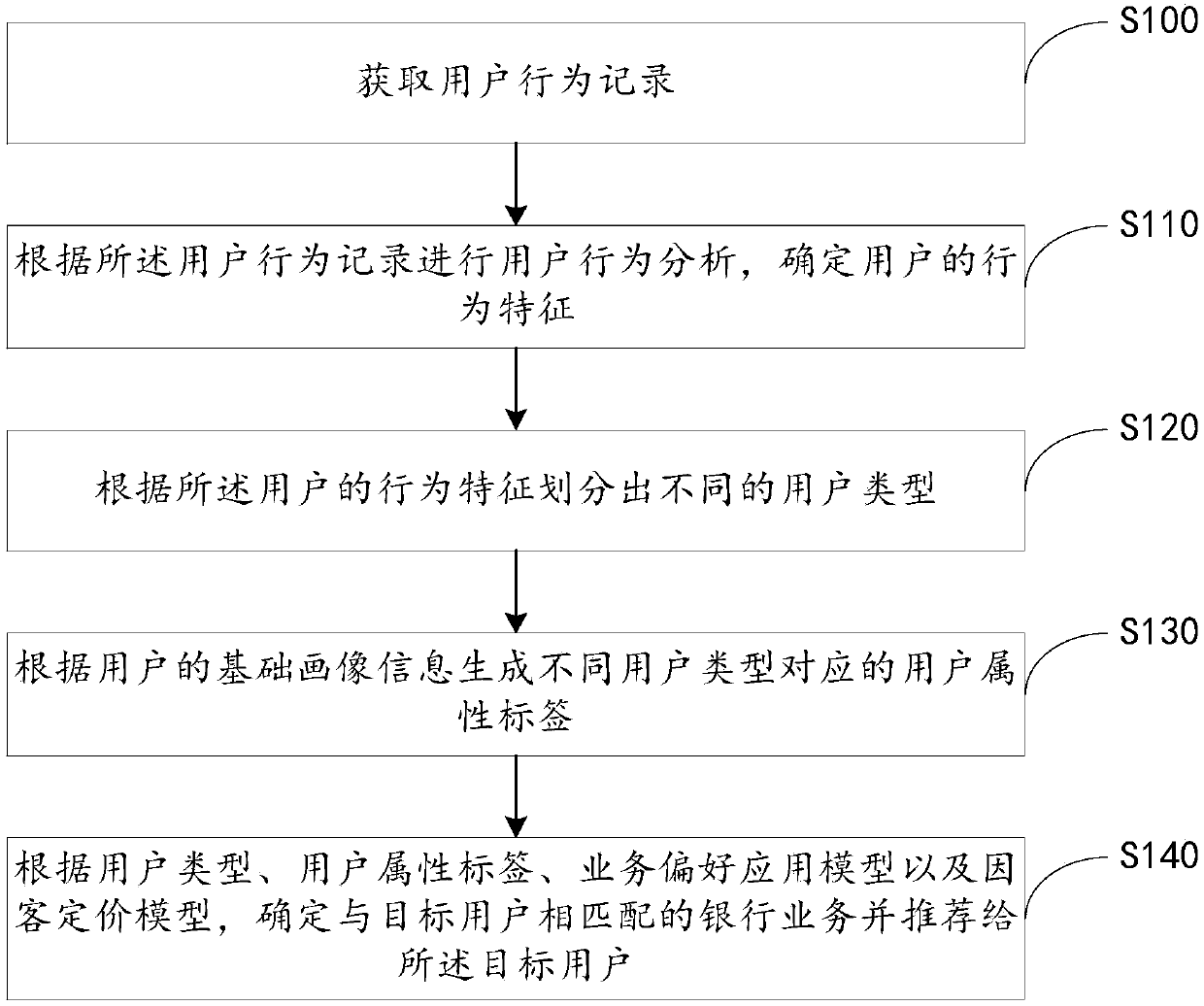

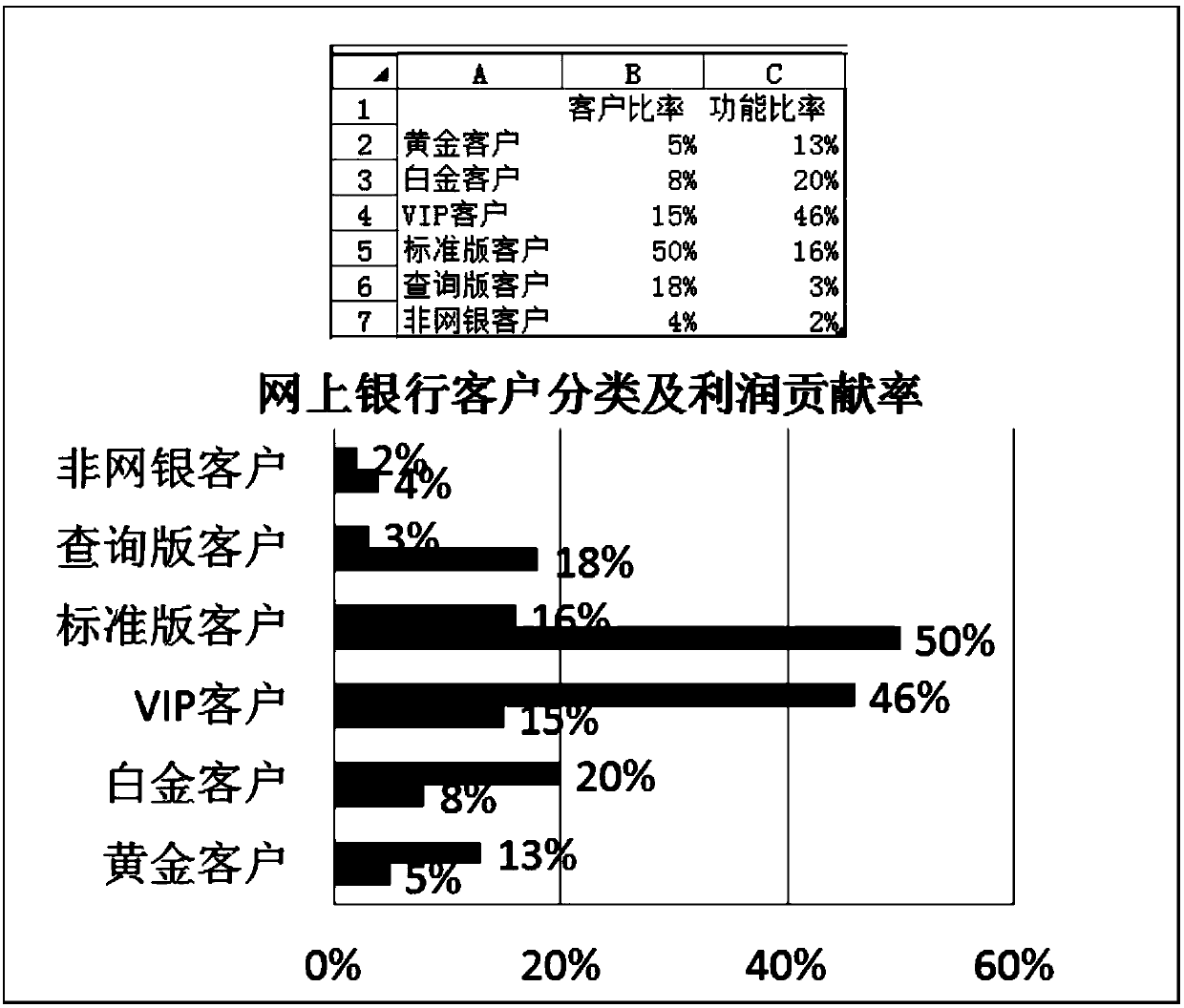

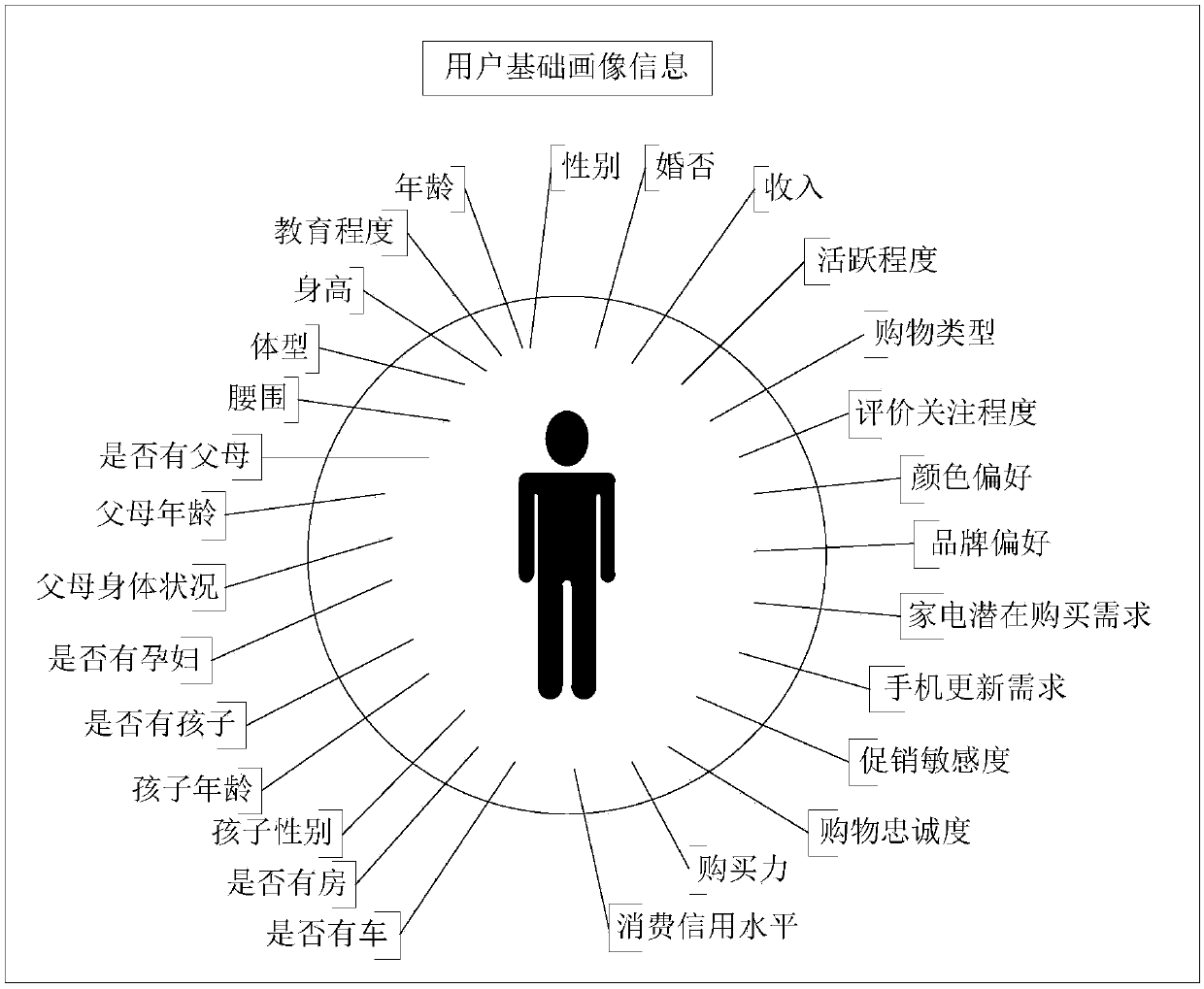

Online bank marketing method and device based on user behavior analysis

The embodiment of the invention discloses an online bank marketing method and device based on user behavior analysis. The online bank marketing method comprises the steps of acquiring user behavior records; performing user behavior analysis based on the user behavior records, and determining behavior characteristics of users; dividing different user types according to the behavior characteristicsof the users; generating user attribute tags corresponding to different user types according to basic portrait information of the users; determining a banking service matched with a target user according to the user types, the user attribute tags, a service preference application model and a customer-based pricing model, and recommending the banking service to the target user. More customers can be won for the online bank.

Owner:BANK OF CHINA

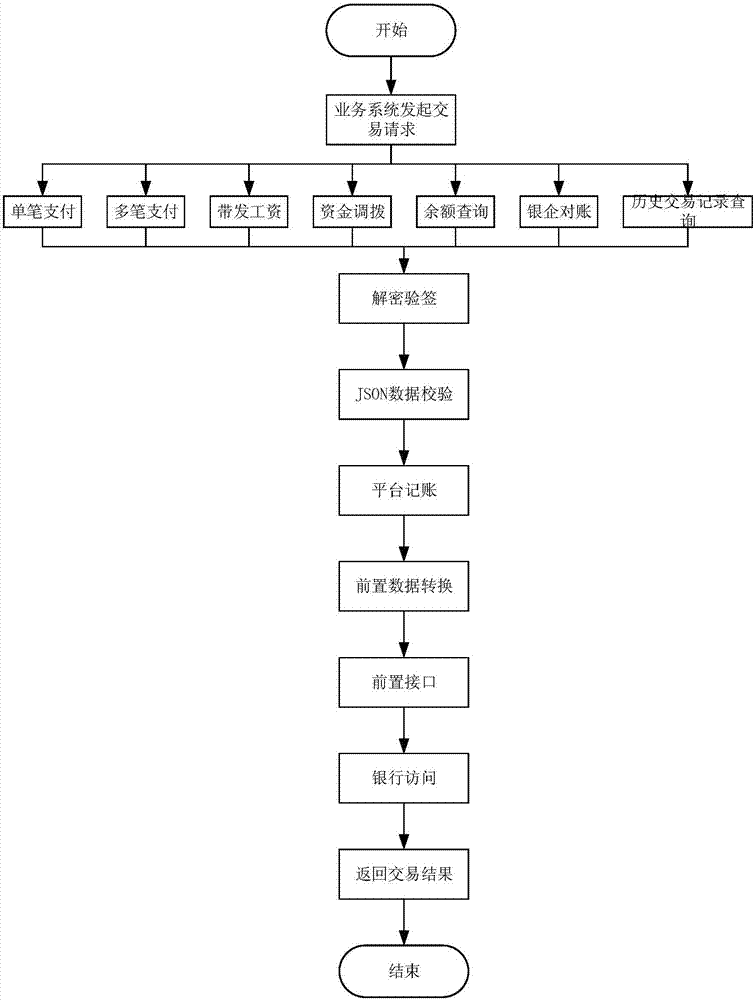

Internet bank-enterprise connection system and method

InactiveCN107516204AReduce operational complexityFinancePayment architecturePaymentSoftware engineering

The invention belongs to the field of Internet paying, discloses an Internet bank-enterprise connection system, and solves the problems that a traditional bank-enterprise connection scheme needs to the connected with the frontal machines of different banks when the traditional bank-enterprise connection scheme faces the business of multiple banks, account information needs to be recorded by different banks, technical difficulty is increased, and operation is complex. The Internet bank-enterprise connection system comprises a bank-enterprise direct-connection platform and is characterized in that the bank-enterprise direct-connection platform is provided with independent frontal machine interfaces according to the standards of various banks so as to communicate with multiple bank systems; the bank-enterprise connection services of multiple banks are provided for enterprise business systems on the basis of unified bank-enterprise connection specifications, various unified payment calling interfaces are provided, and enterprise transaction data is recorded. In addition, the invention further provides an Internet bank-enterprise connection method applicable to various enterprise business systems.

Owner:SICHUAN CHANGHONG ELECTRIC CO LTD

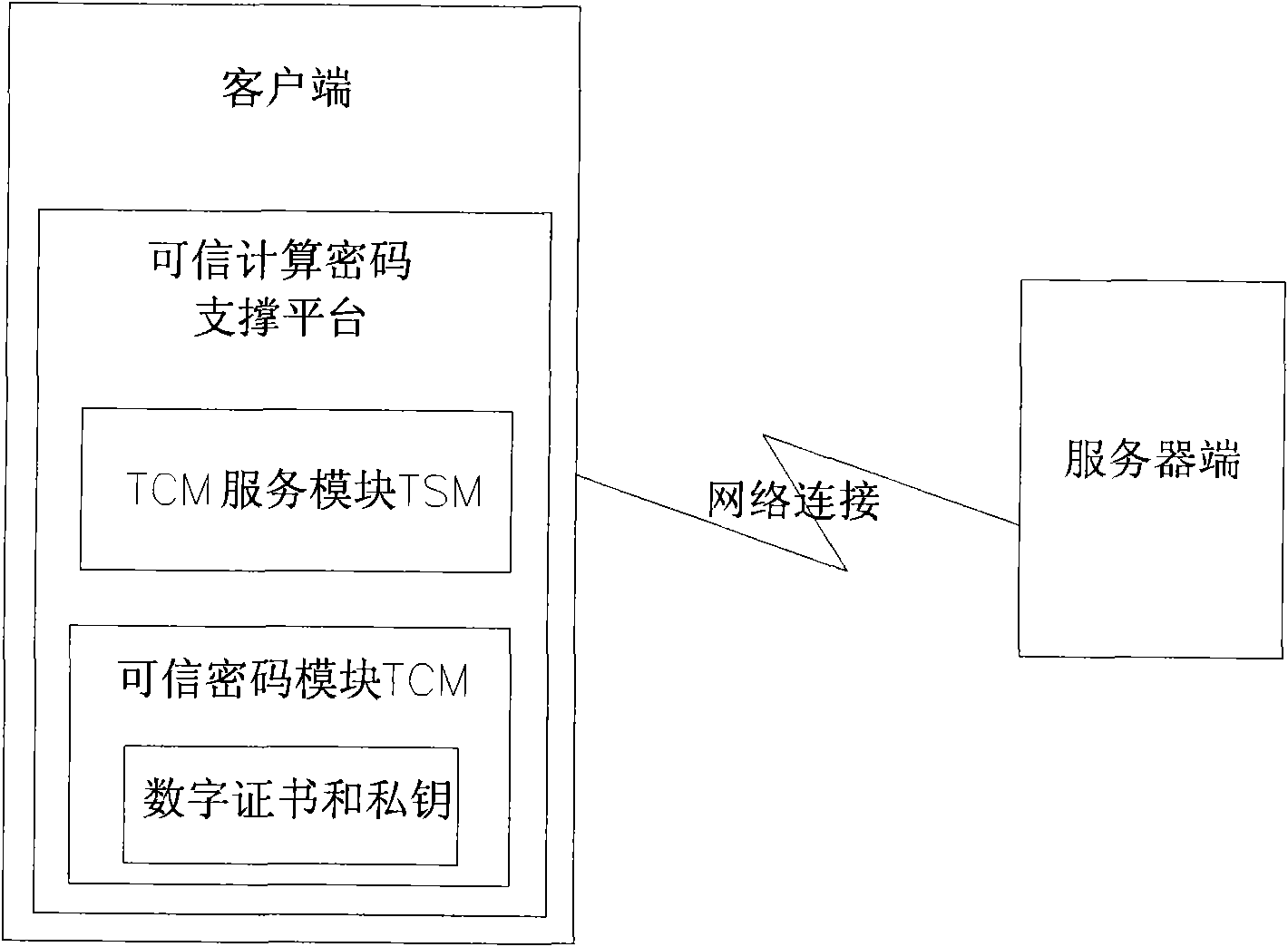

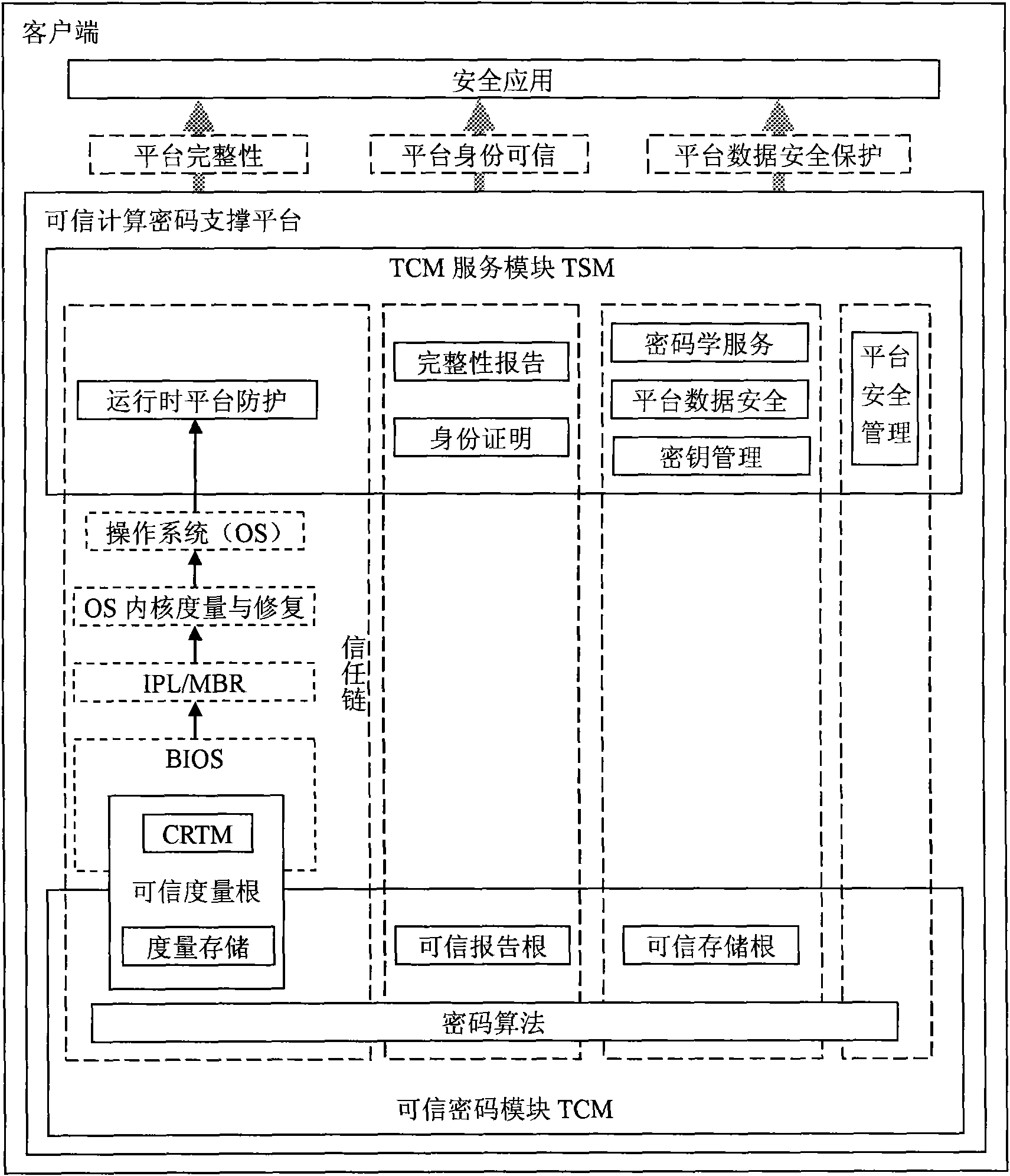

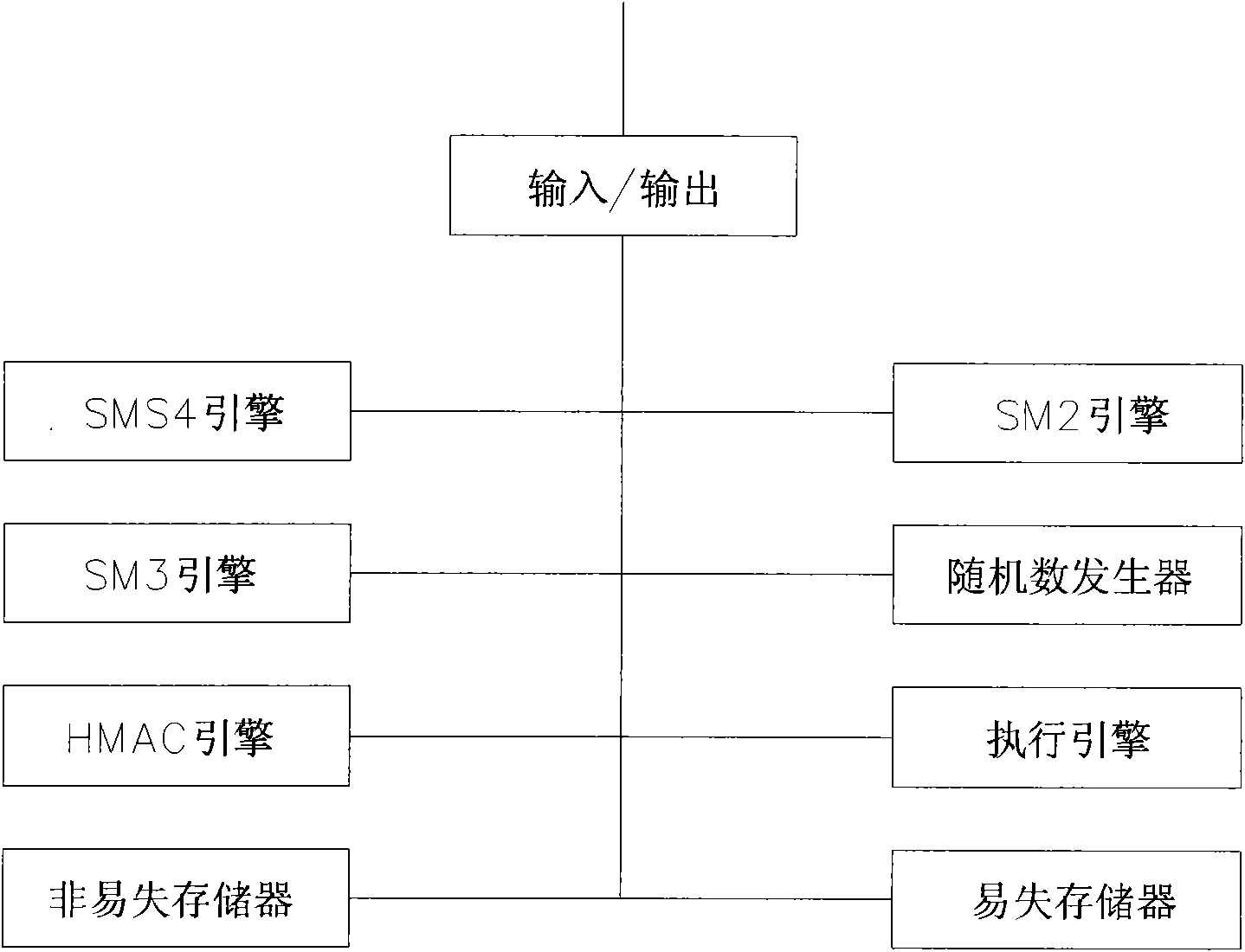

Safe web bank system and realization method thereof

InactiveCN101527024AIntegrity guaranteedLow costFinanceDigital data authenticationCode moduleNetwork connection

The invention provides a safe web bank system and a realization method thereof, and relates to information security technology. The system comprises a server end and a client which are connected through a network. The system comprises structural characteristics that a trusted computing code supporting platform comprising a trusted code module TCM and a TCM service module TSM is embedded in the client; and a digital certificate and a private key acquired by a customer from a bank store is positioned in the trusted code module TCM. Compared with the prior art, the safe web bank system and the realization method thereof construct a trusted computing environment by using a TCM security chip, and have the characteristics of low cost, high security, good reliability, and convenient use.

Owner:TSINGHUA TONGFANG CO LTD

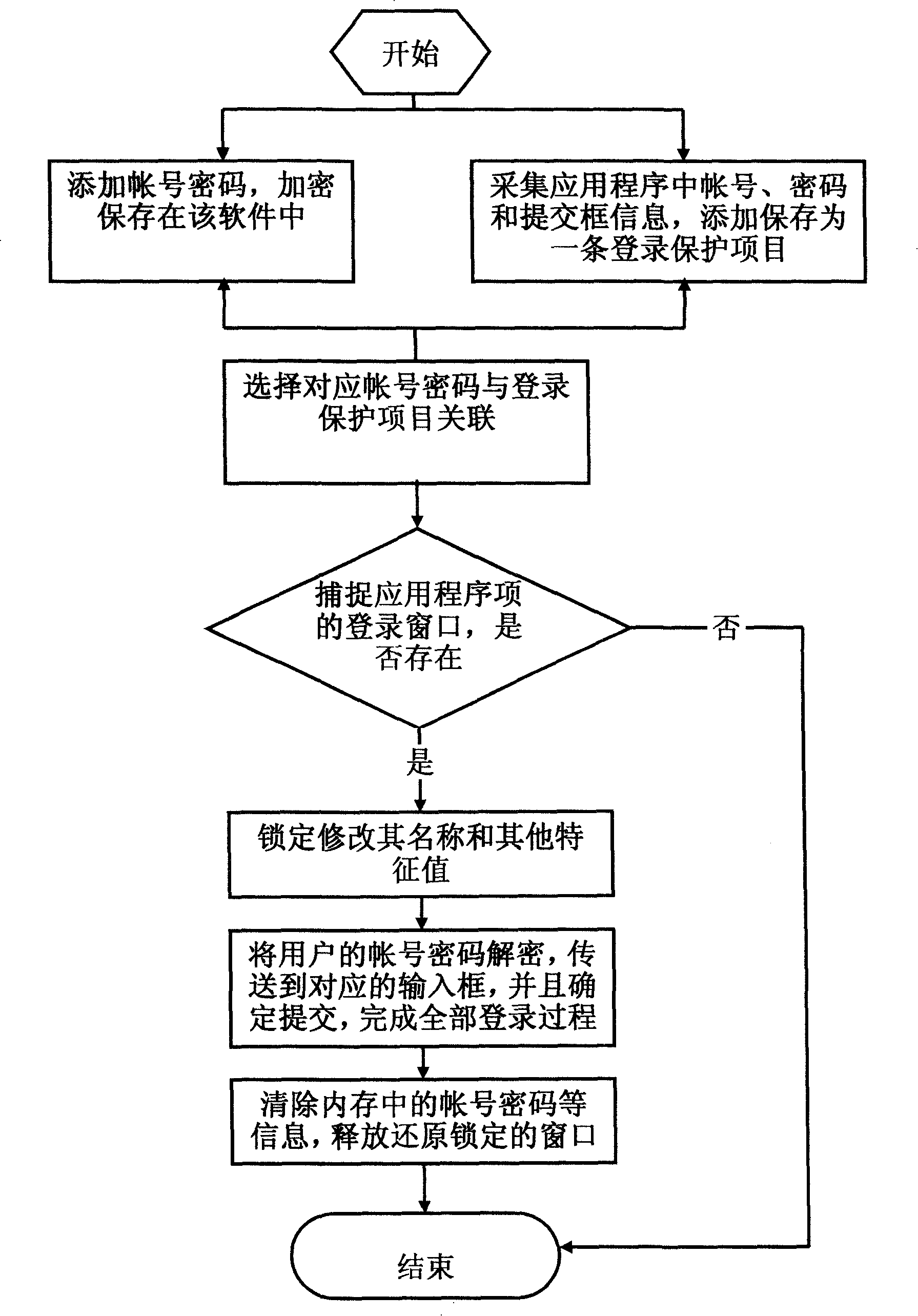

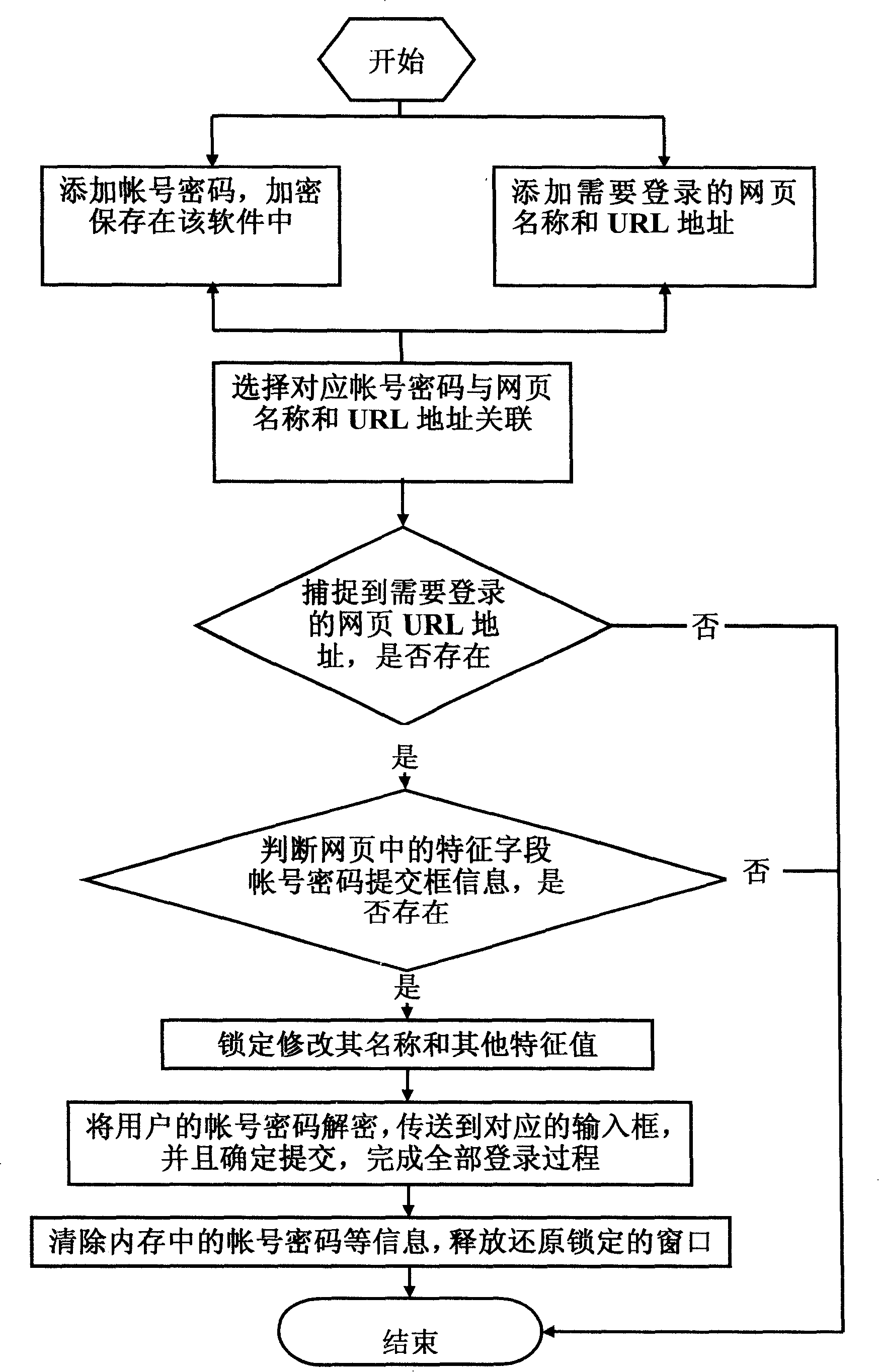

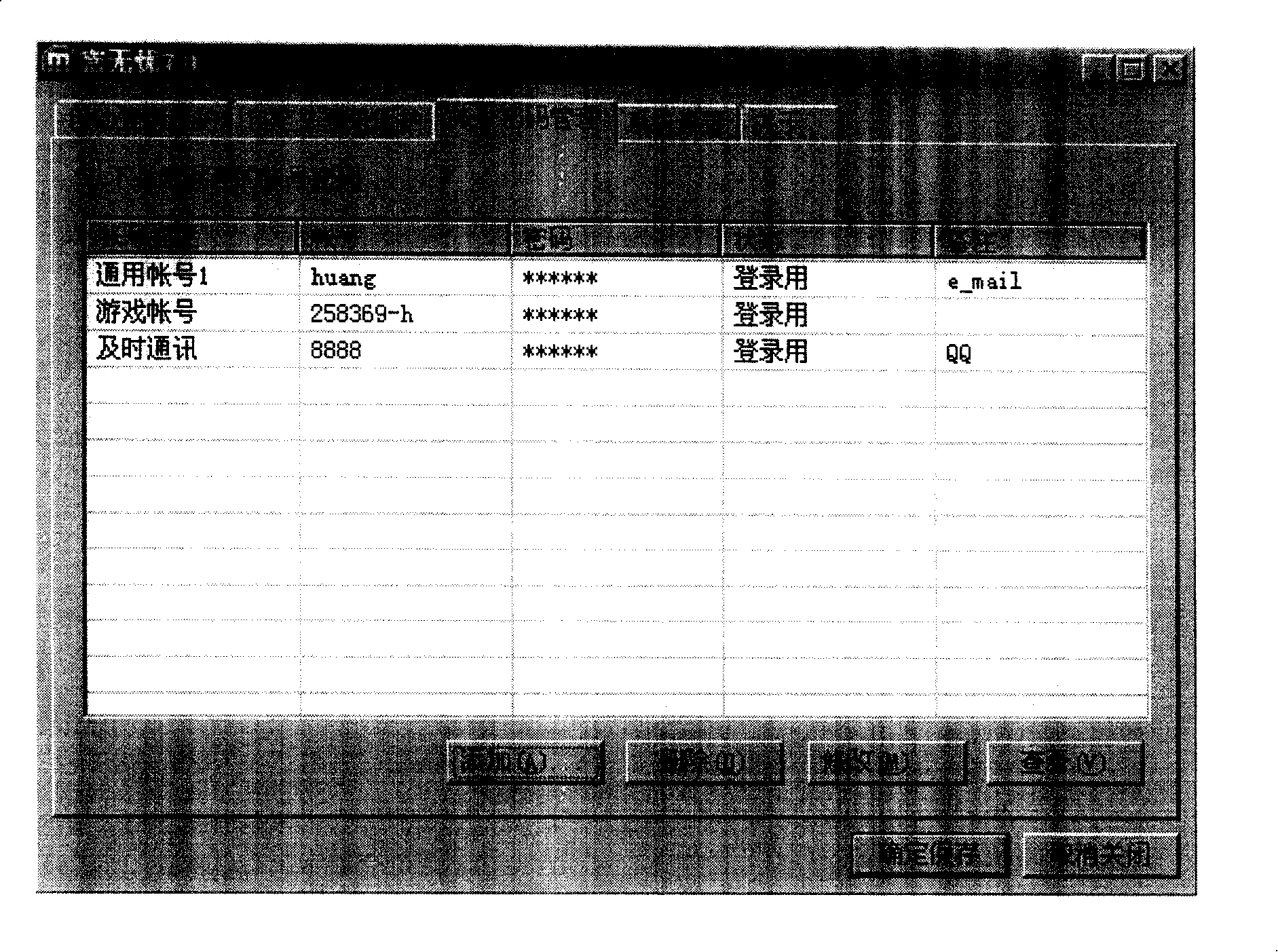

A logging-on process cipher protection method by means of background synchronization

InactiveCN101216867APrevent leakagePrevent Masquerade FraudUser identity/authority verificationInternal/peripheral component protectionOperational systemApplication software

The invention relates to the computer field, in particular to a password protection method which utilizes a background synchronization method to complete the login process. The method comprises the following steps: an account password is encrypted and saved in a local file via a computer software; the software automatically captures and locks application procedures, client software or web pages, which need to login, at the background of an operation system, then decrypts and sends the account password under a protection state, confirms, submits and simultaneously completes the login process; then the account password information in a memory is cleaned up, thereby protecting each detail in the processes of transporting and submitting the password on a local computer. The invention effectively prevents the harmful procedure from stealing the account password of a user; the user does not need to enter the account password at each time, and the filling and login process is completed automatically by the software; in addition, the invention has the advantages of safety, rapidity and good protection effects on instant messaging, network games, e-business, internet banking, forum blogs, client software and various login applications.

Owner:黄承雄

Method and system for internet banking and financial services

A computer implemented method of providing a client with an integrated financial management account, comprising, receiving application data for an integrated financial management account, setting up the integrated financial account with a loan component data, an investment component data, and an insurance component, all associated with an account file. Qualifying the client for a loan in the loan component of the integrated financial management account and associating the qualification information with the account file. Disbursing the proceeds of the loan component into the investment component by recording a proceed value in the investment component data associated with the account file and purchasing investment assets using the proceeds of the loan component and associating purchased investment assets to the investment component data associated with the account file.

Owner:NOLAND CATHLEEN

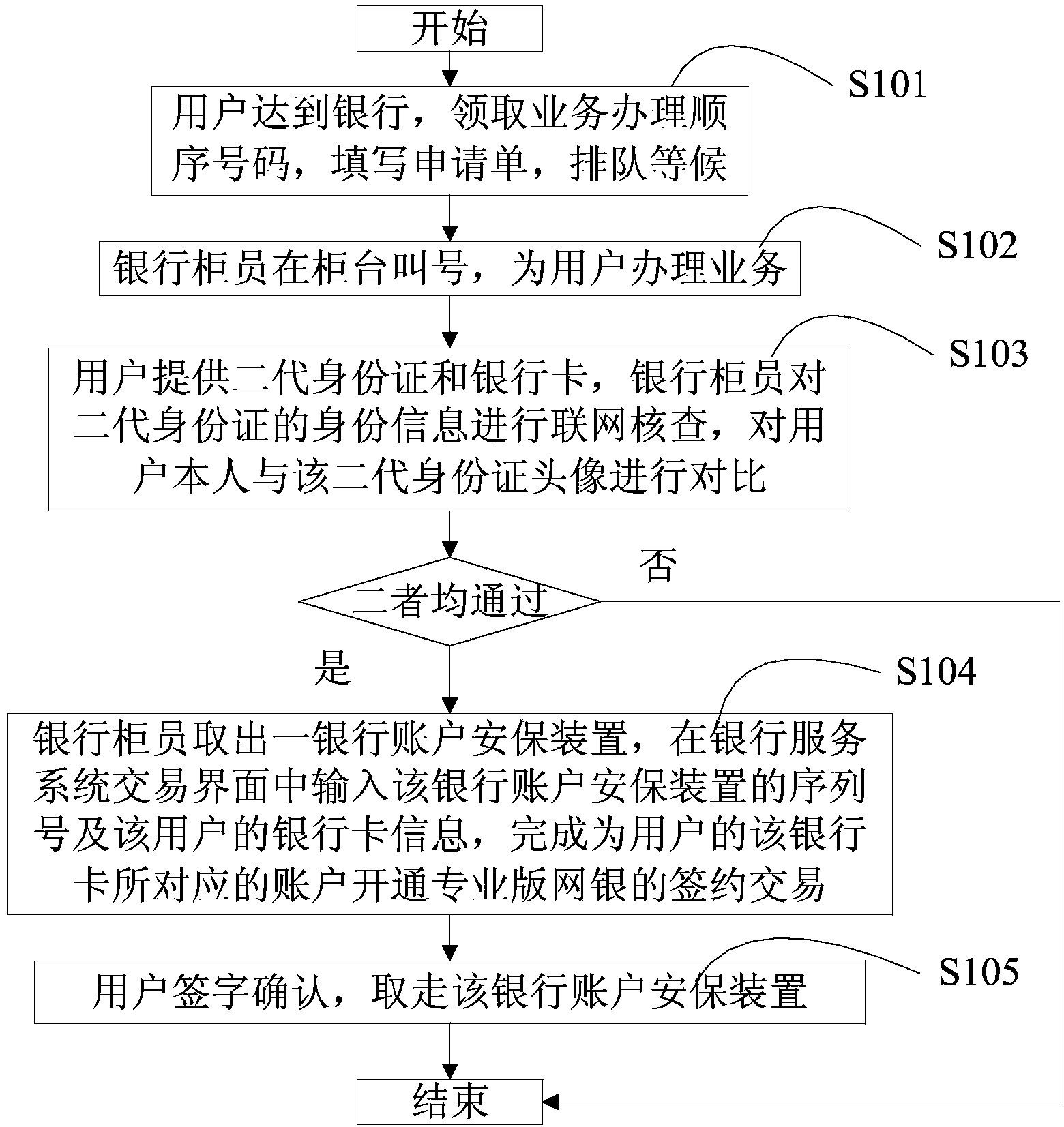

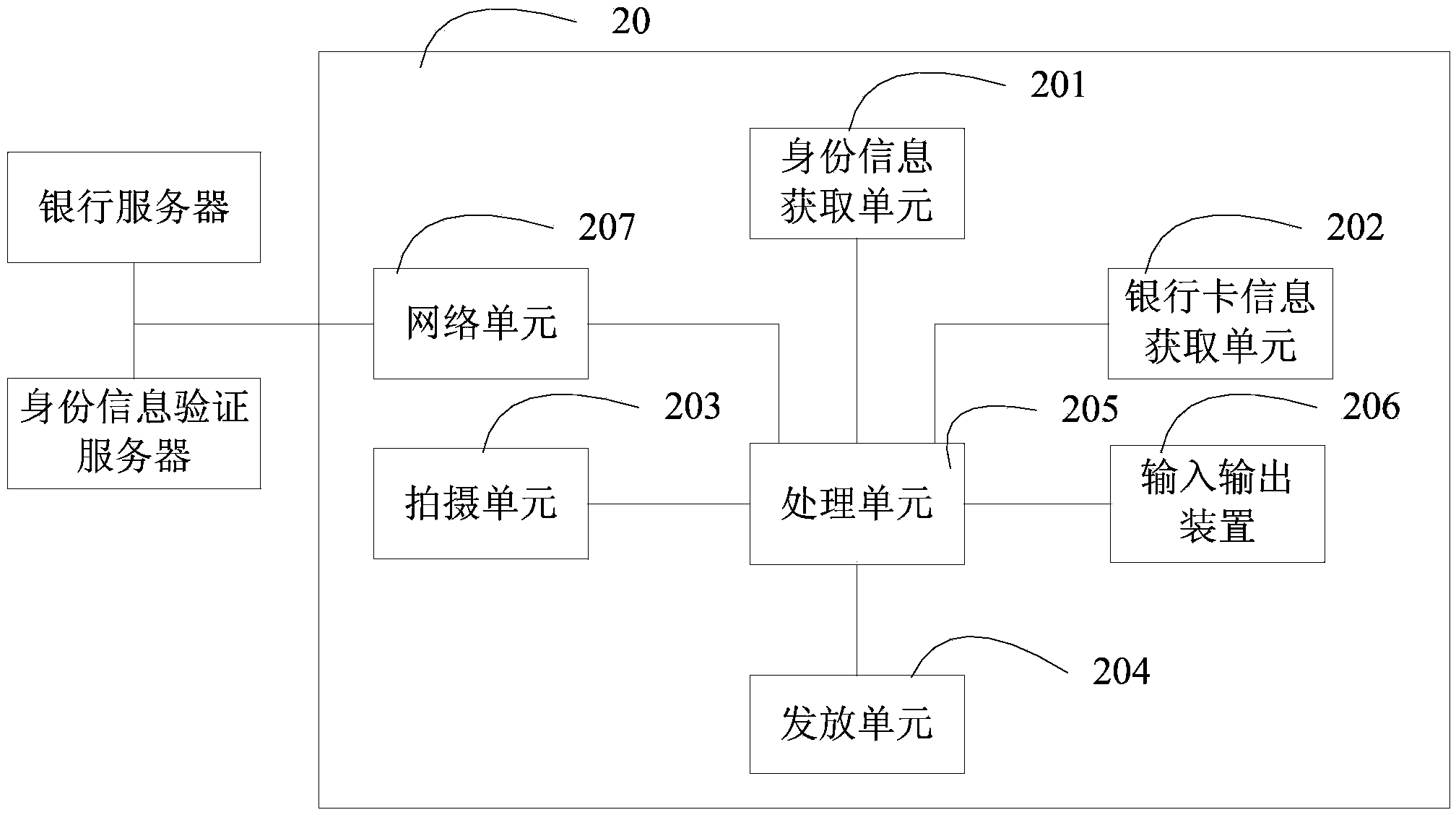

Bank account security device self-service issuing device and method

ActiveCN103679963ASimple, convenient, accurate and safe to obtainComplete banking machinesProtocol authorisationBank accountSelf-service

The invention discloses a bank account security device self-service issuing device and method. The bank account security device self-service issuing device comprises an identity information obtaining unit, a bank card information obtaining unit, a shooting unit and / or a fingerprint collecting unit, an issuing unit and a processing unit, wherein the identity information obtaining unit reads the identity card of a user to obtain the identity information and sends the identity information to an identity information verification server to carry out networking check on the identity information, the shooting unit is used for obtaining image data of the user, the fingerprint collecting unit is used for collecting fingerprint feature codes of the user, the issuing unit extracts a standard bank account security device packaging unit to be issued and reads the serial number of the standard bank account security device, the processing unit carries out similarity calculation on head portrait data and the image data, and / or carries out similarity calculation on the fingerprint data and the fingerprint feature codes. Internet bank networking contact signing is carried out after similarity calculation succeeds and networking check succeeds, and the standard bank account security device packaging unit is output after contact signing succeeds.

Owner:BEIJING ORIENT XINGHUA TECH DEV CO LTD

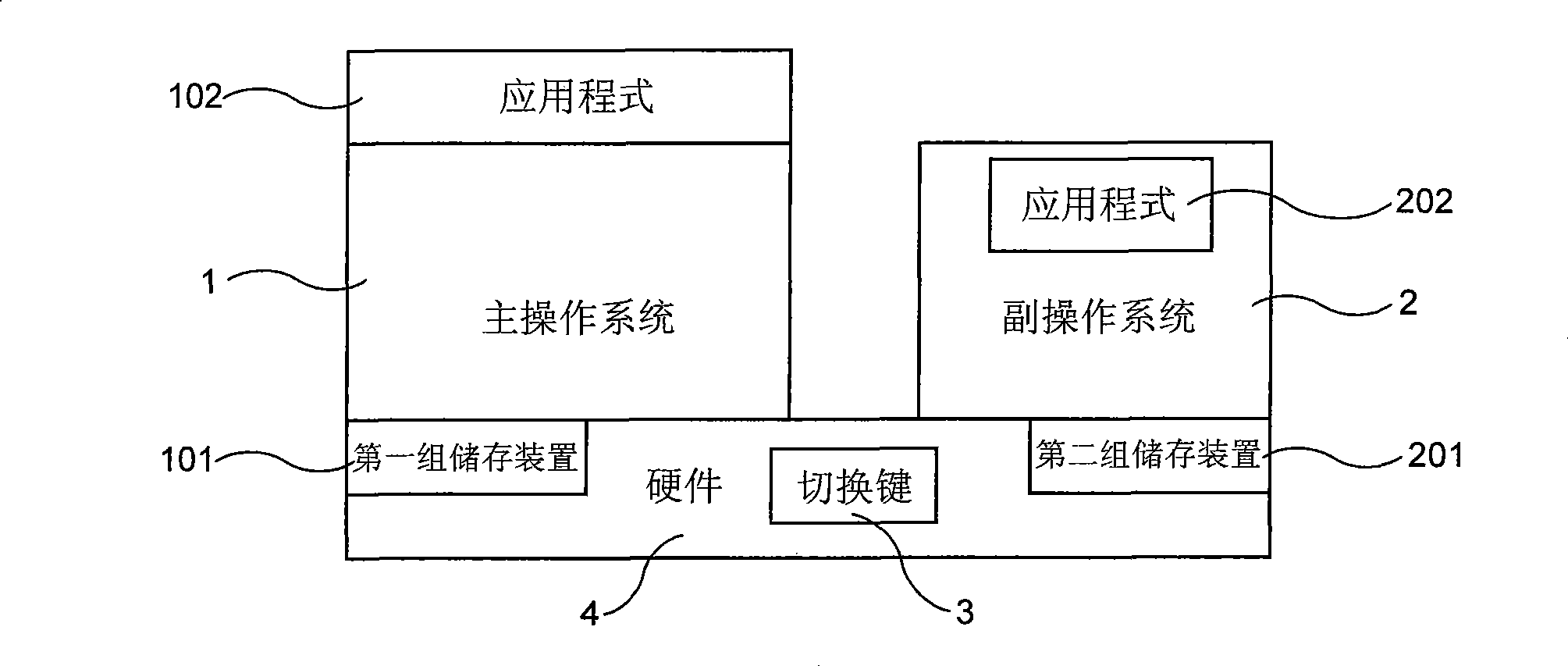

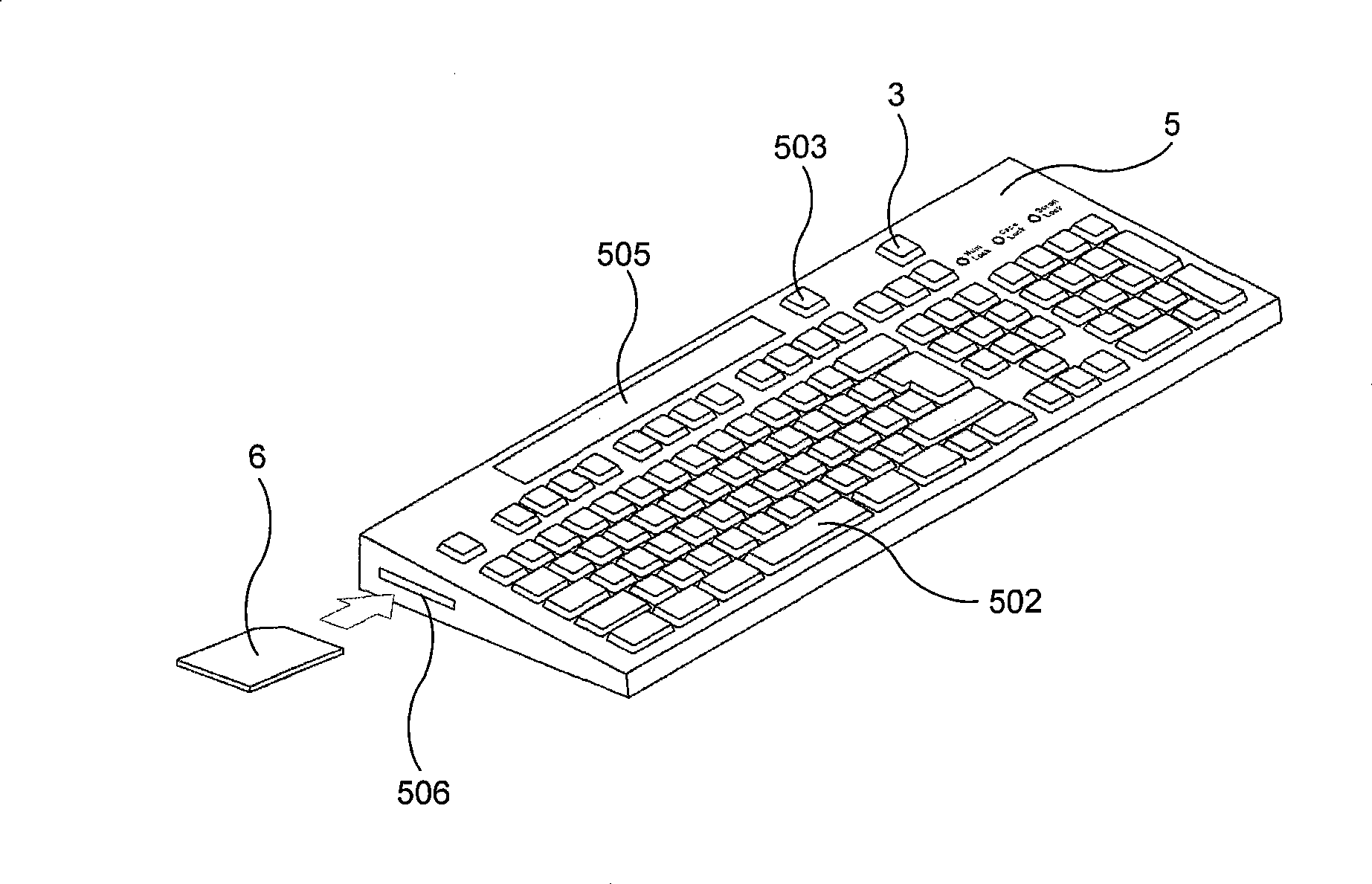

Double operating system computer against worms

InactiveCN101364187AEnsure safetyProgram initiation/switchingUser identity/authority verificationOperational systemThe Internet

The invention relates to a computer with double operating systems, which comprises a primary operating system (1), a secondary operating system (2), a switch key (3) used for selecting a current operational operating system, a first storage device (101) and a second storage device (201), wherein, the first storage device (101) is independently separated from the second storage device (201) in body; and is only used for accessing the main operating system (1); and the second storage device (201) is only used for accessing the auxiliary operating system (2). The main operating system (1) can be used for a majority of application with low safety requirements such as online, playing games and the like; the auxiliary operating system (2) is mainly used for application with high safety requirements such as internet banking service, processing confidential and important files, receiving and sending E-mails and the like, and only can execute a formula prearranged inside, thereby avoiding the intrusion of various viruses and Trojan horse formulae.

Owner:黄金富

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com