Method and system for internet banking and financial services

a financial management and internet banking technology, applied in the field of internet banking and financial services, can solve the problems of largely failure, partially successful, and relatively high cost of loans, and achieve the effect of convenient use for internet customers

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

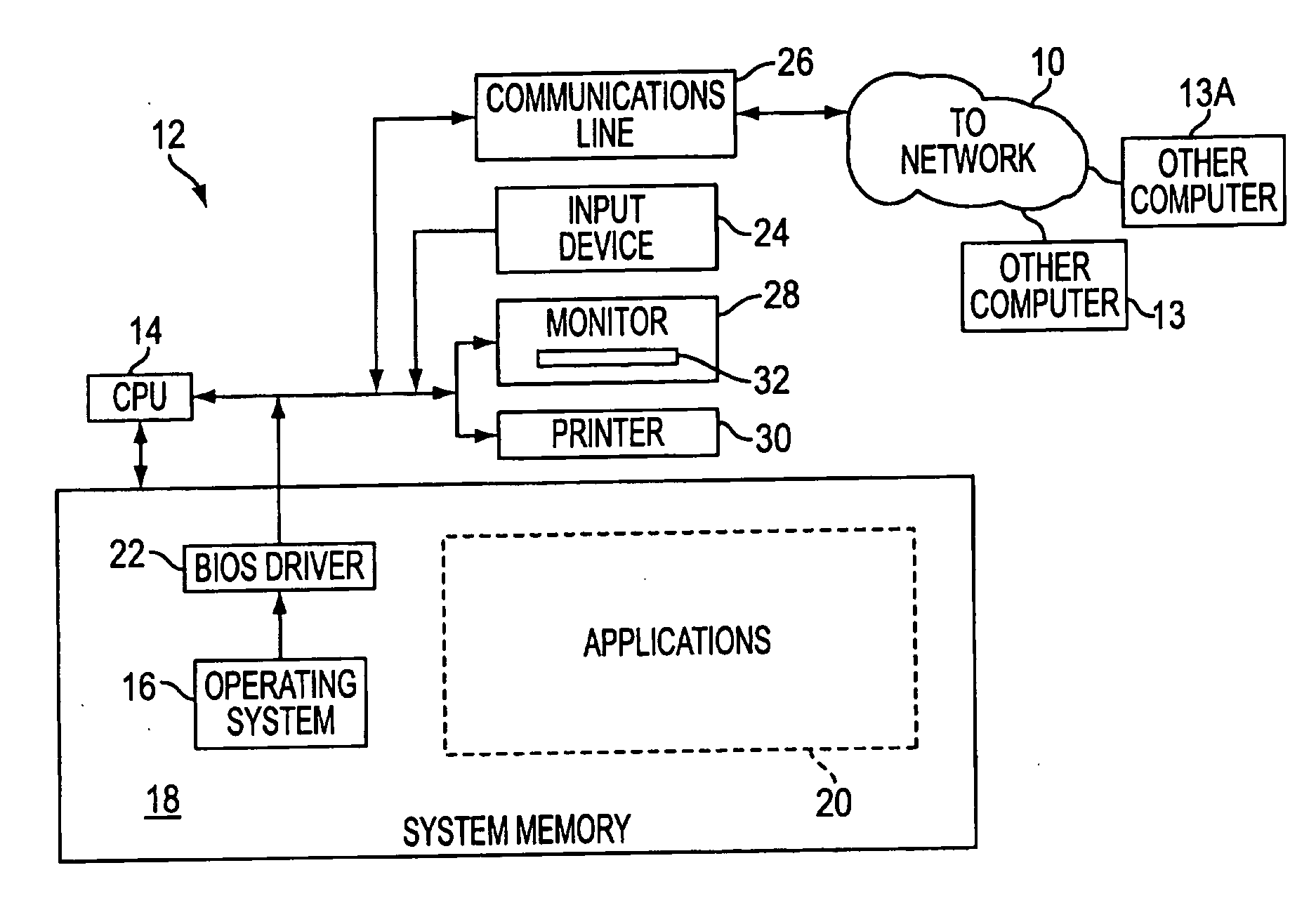

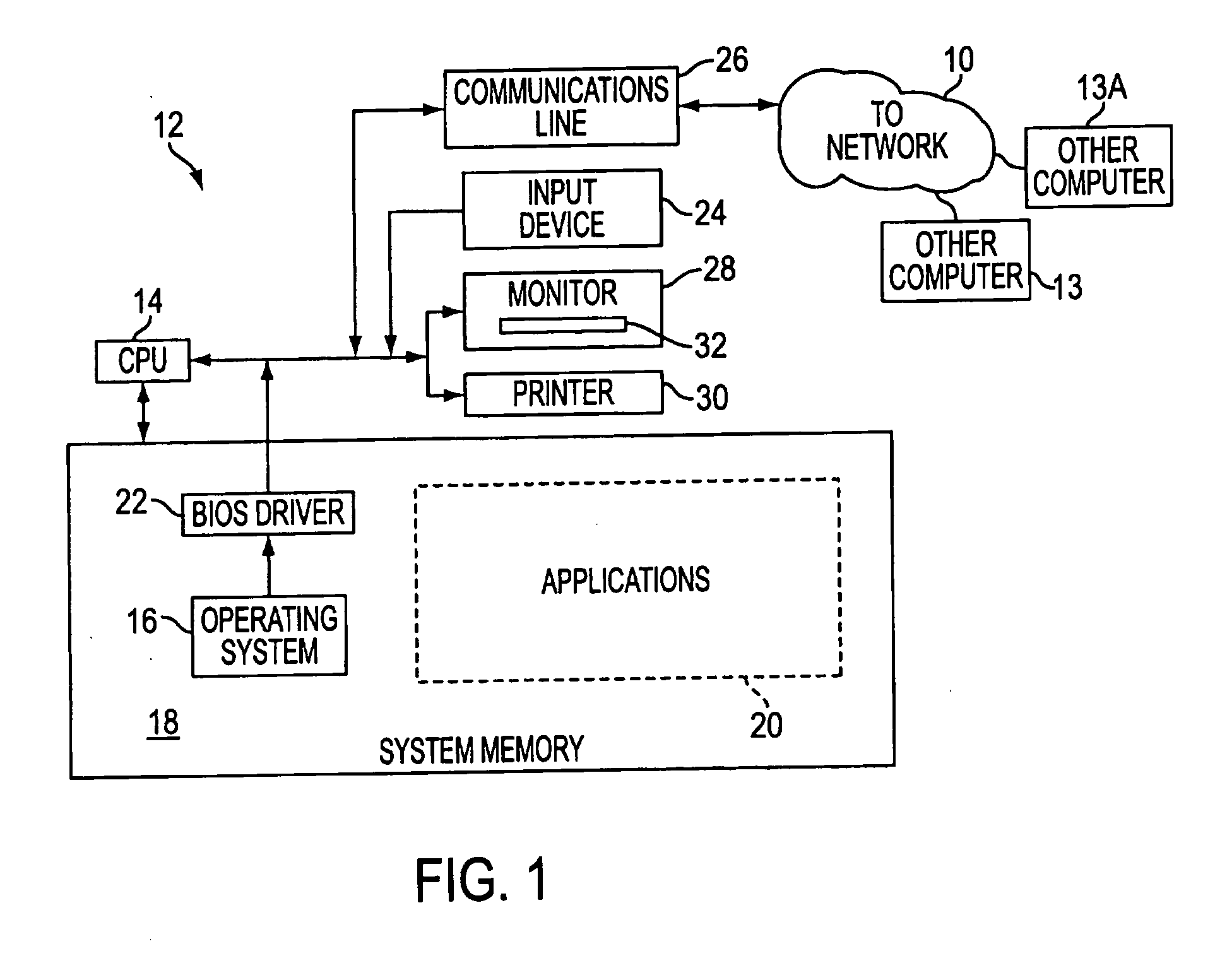

Method used

Image

Examples

Embodiment Construction

)

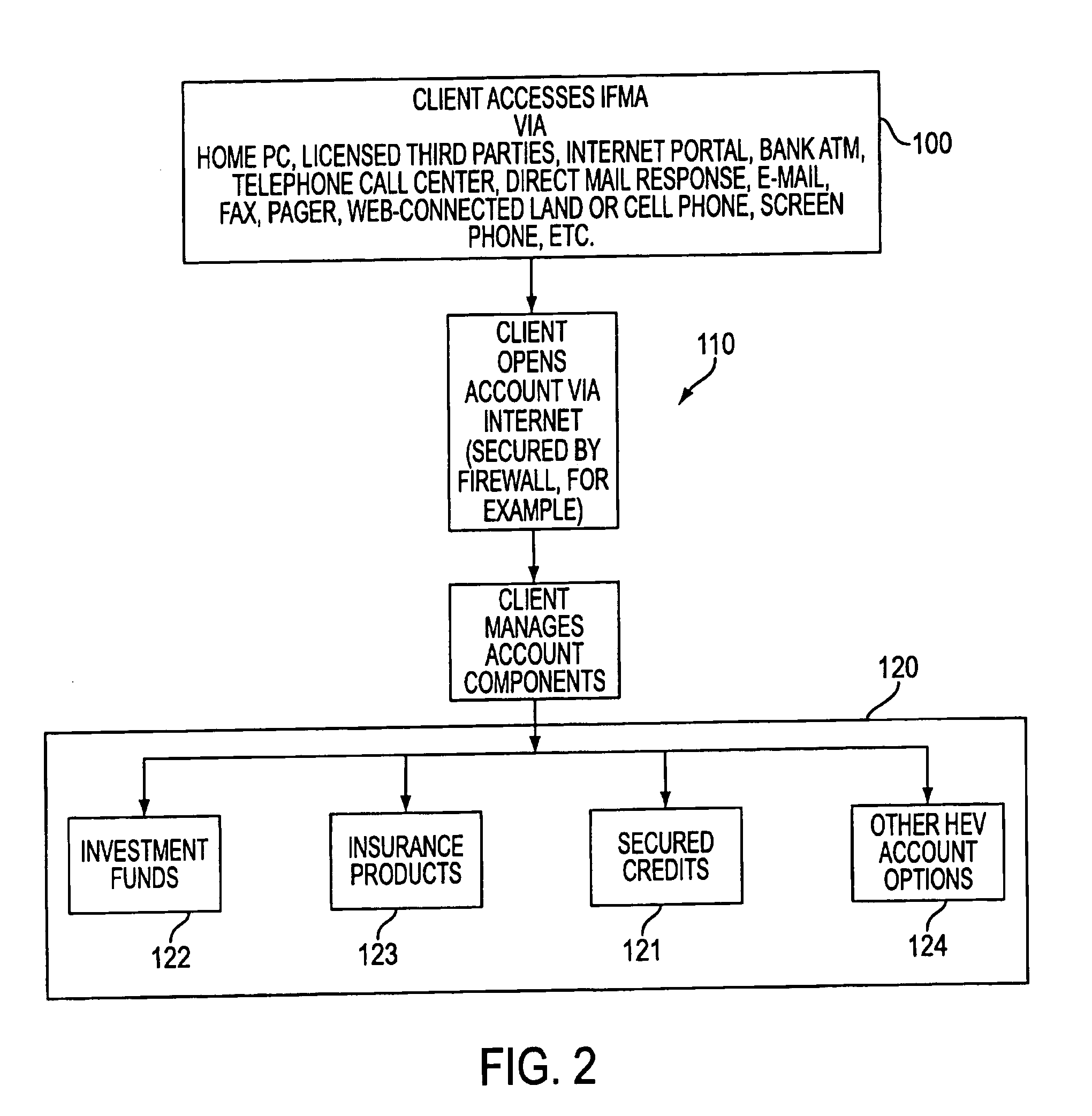

[0053] The present invention recognizes that there is a need for a fully integrated financial management account that enables homeowners (or owners of other collateral assets that can be pledged) to open a single account with qualified investment assets and a home equity loan in the same account so that a customer can customize the account's asset and liability characteristics at the time the customer opens the account, and permits the customer to change those characteristics at their discretion 24 hours a day from any location using a personal computer, the Internet, or other suitable telecommunications network for the account to change options within the plan sponsor' menu of plan modification choices. In addition, the inventors have recognized a need for an account that has the option of automatically having a margin loan in the account to purchase additional investment assets for the account. The inventors have also recognized a need to have a financial services account that pe...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com