Patents

Literature

34 results about "Card association" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A card association is a network of issuing banks and acquiring banks that process payment cards of a specific brand.

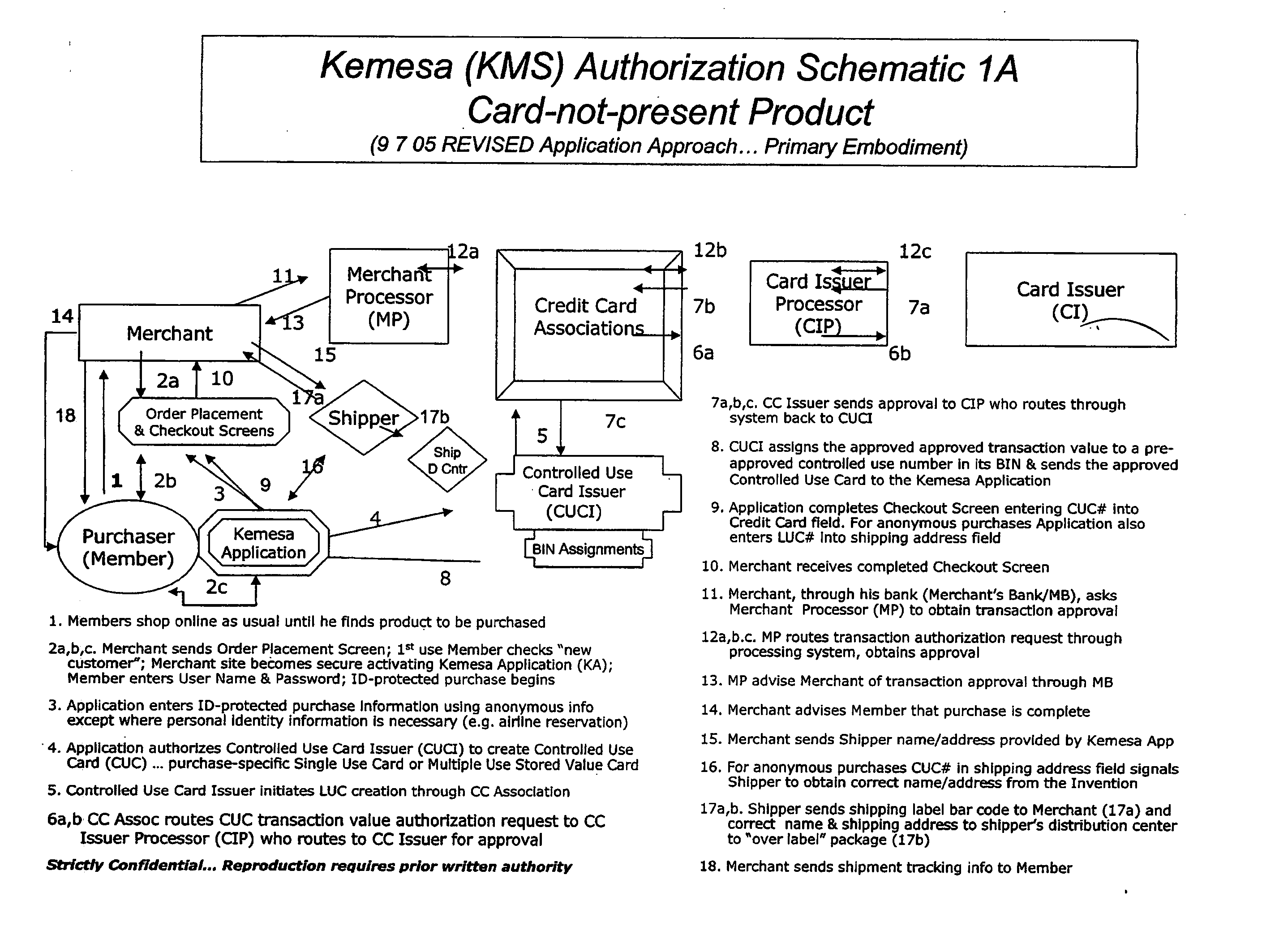

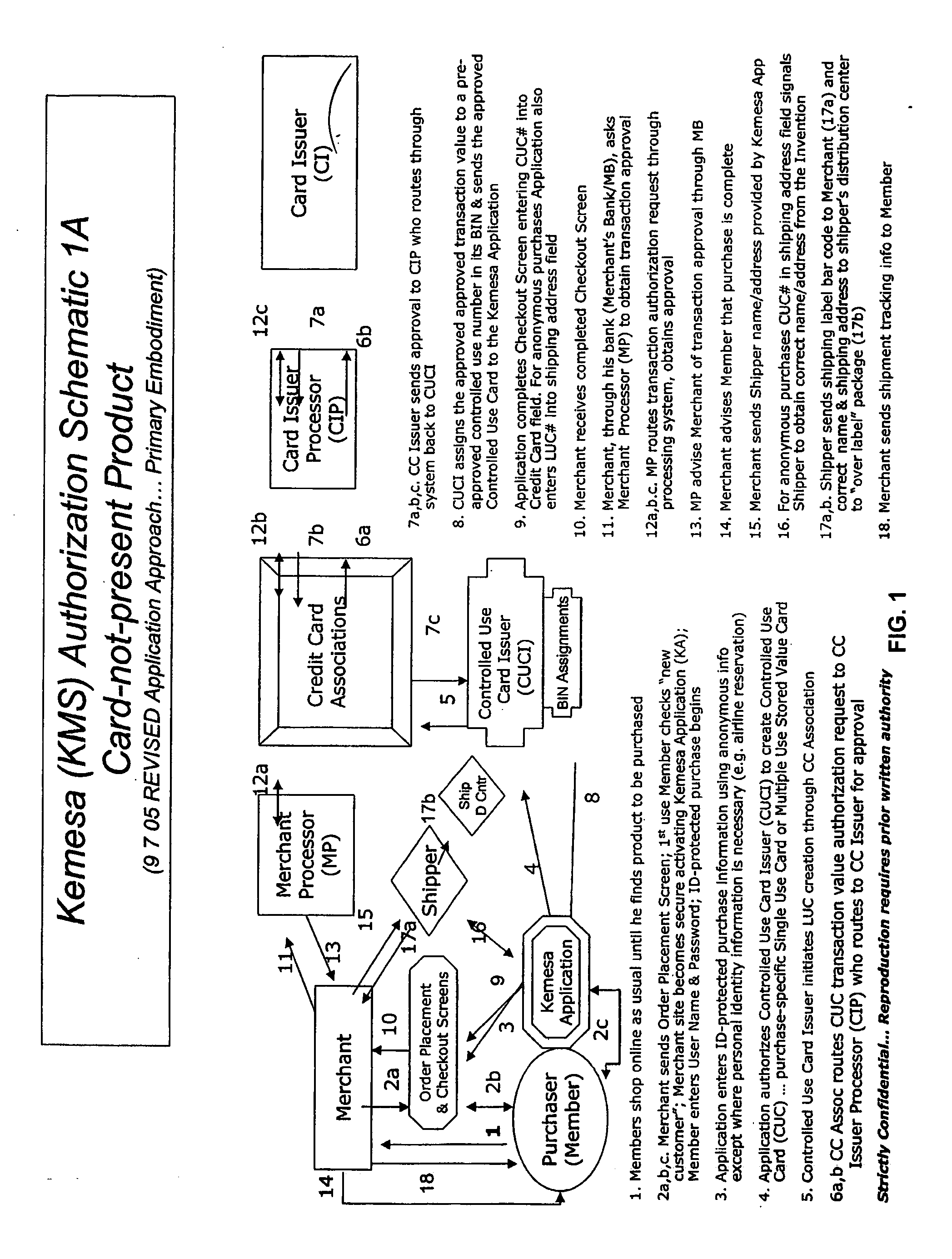

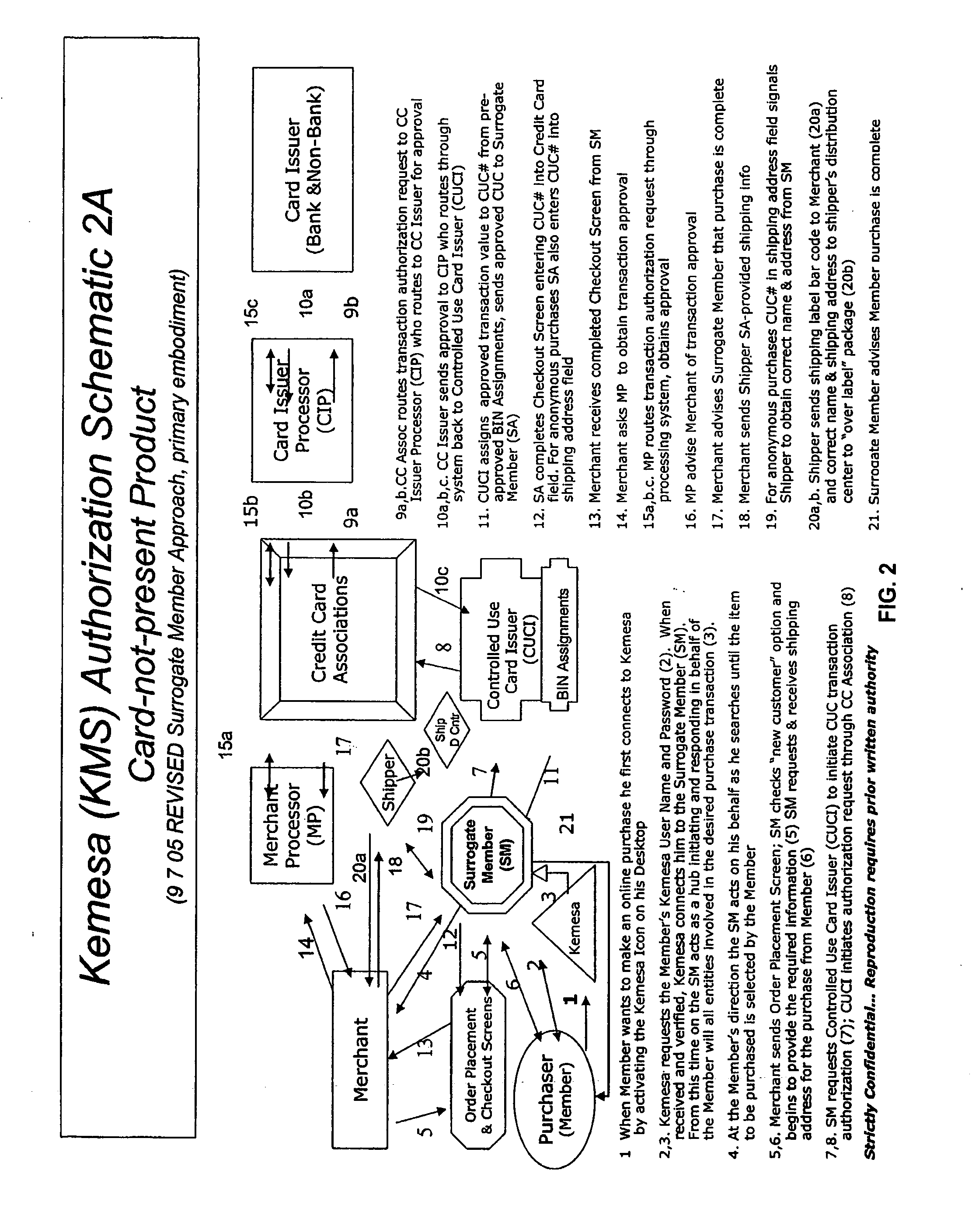

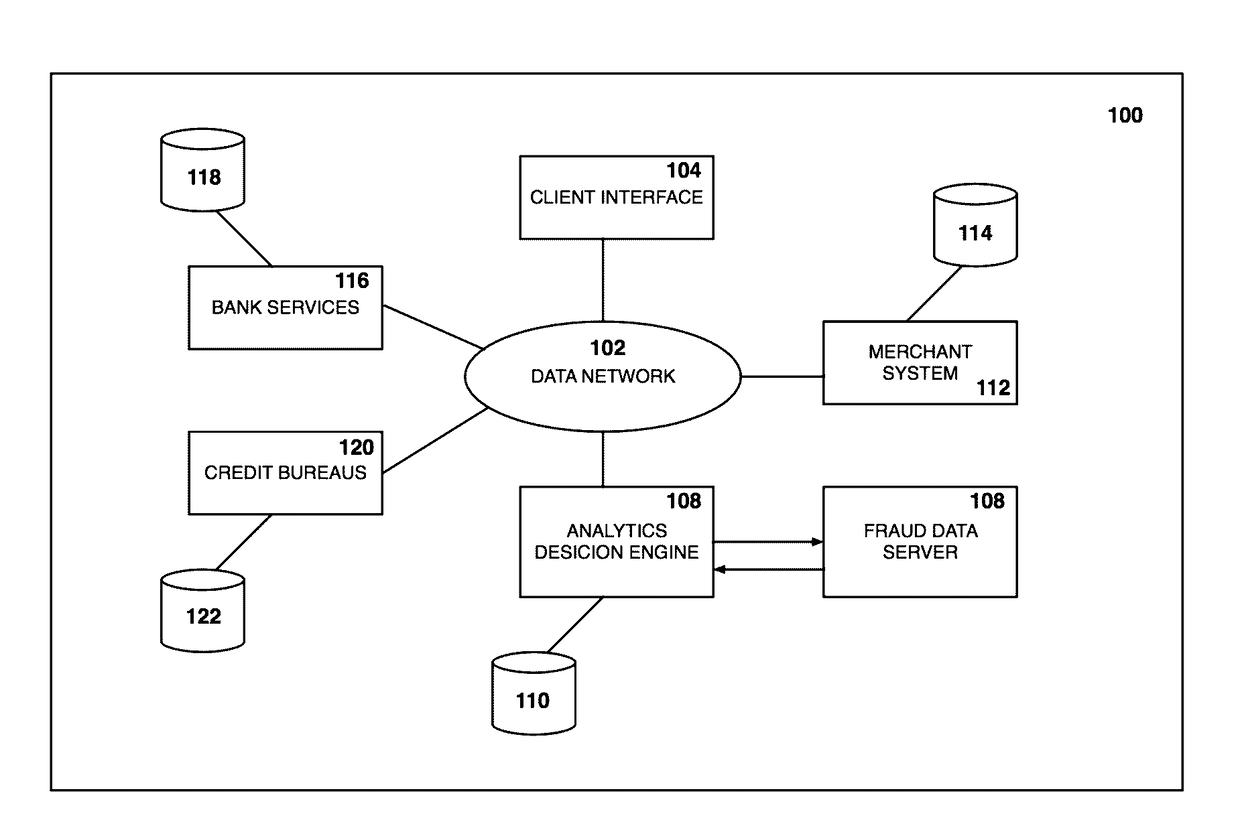

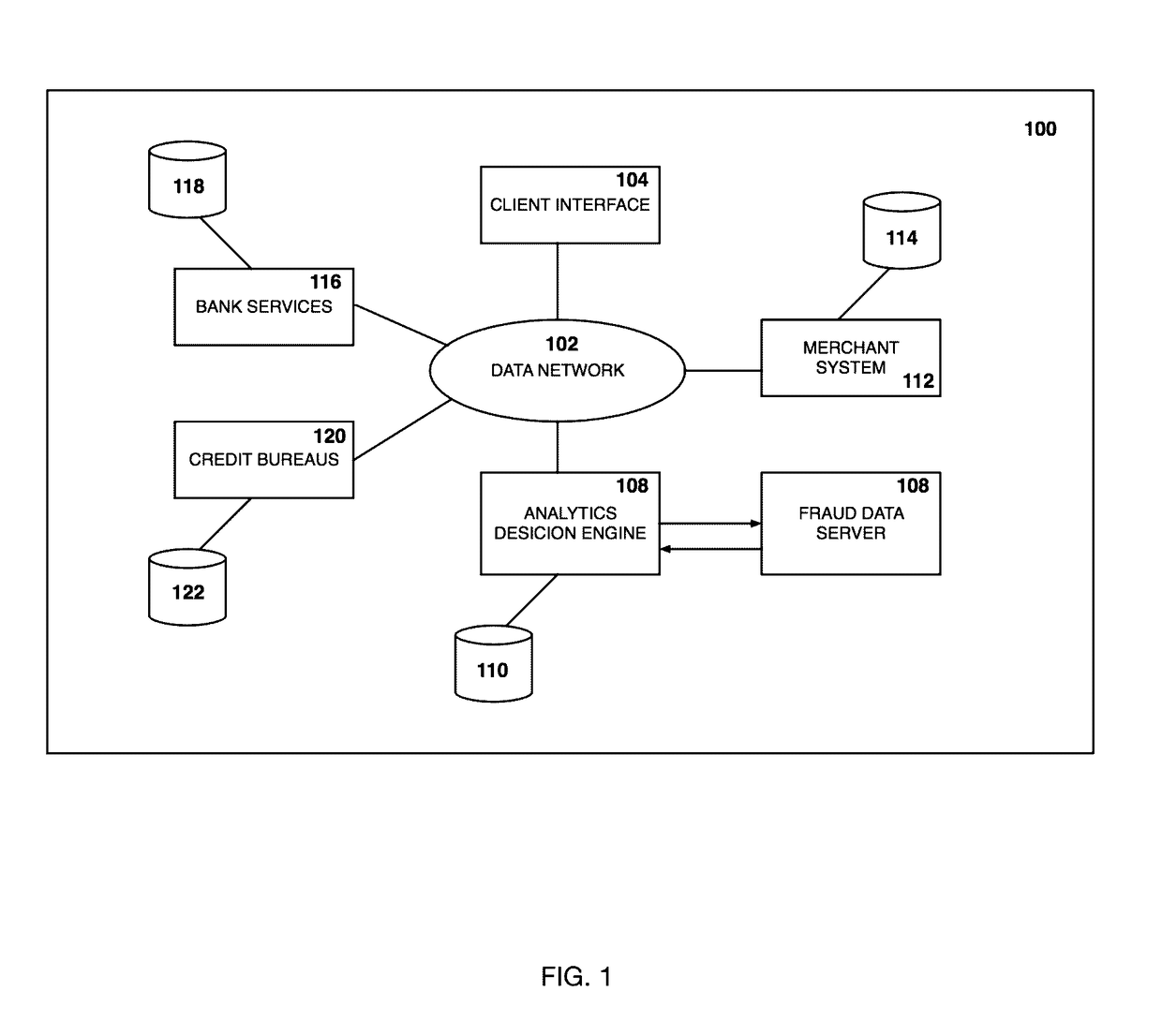

Identity theft and fraud protection system and method

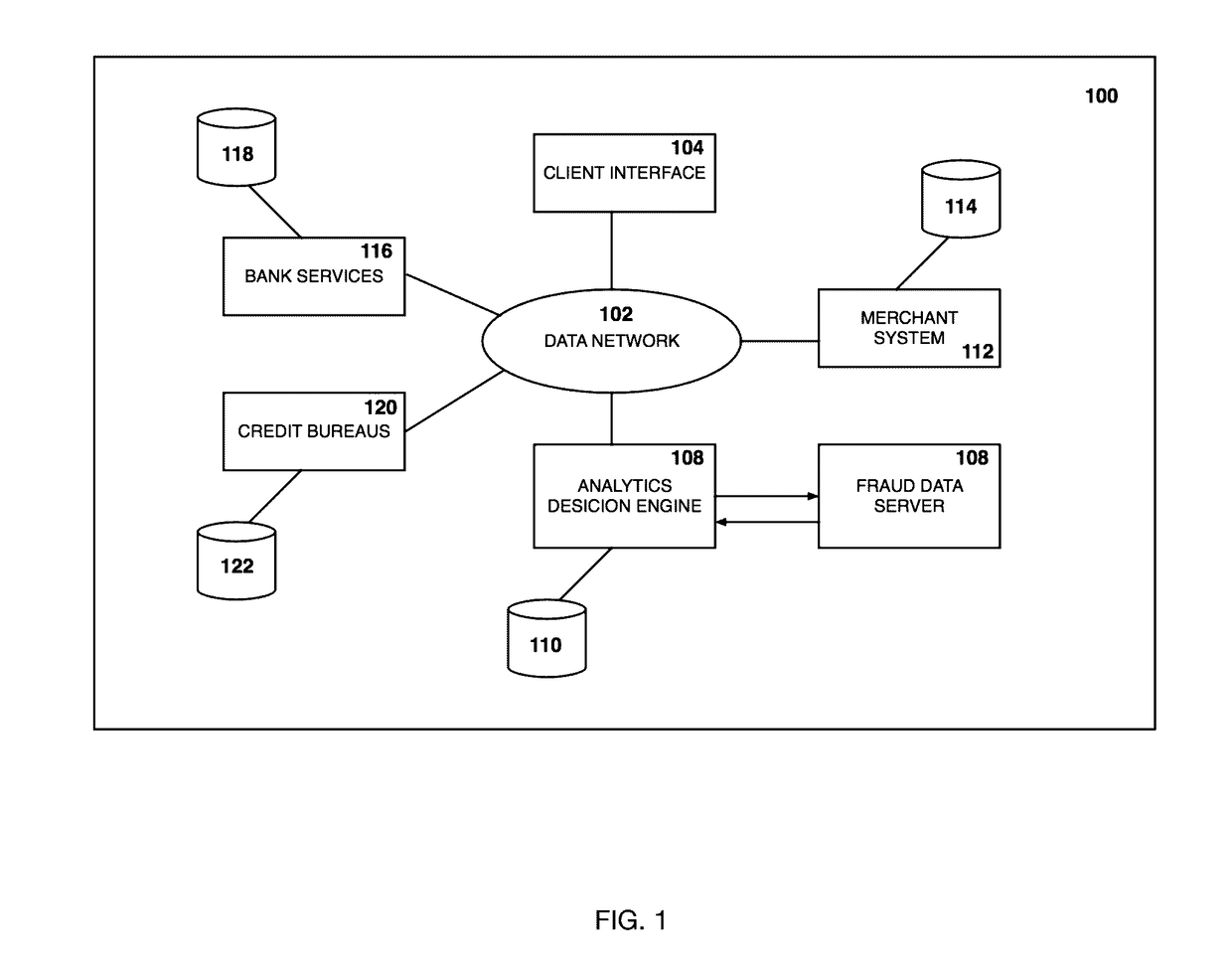

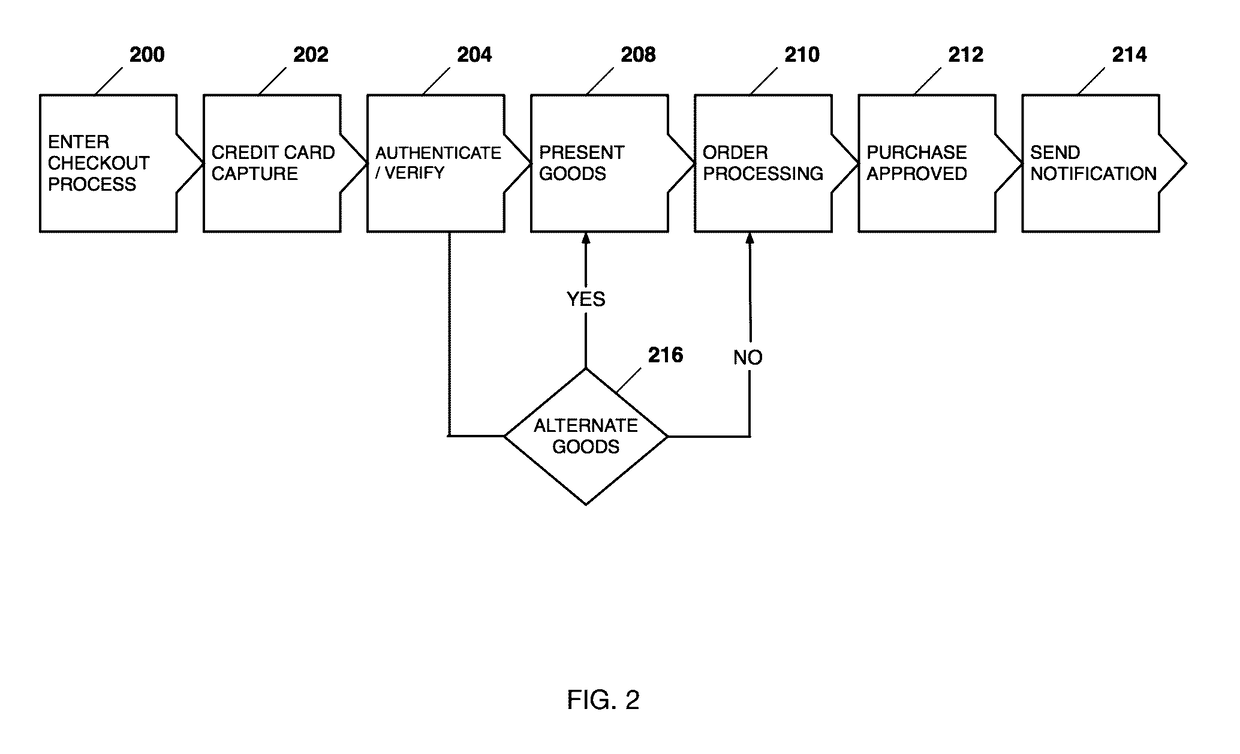

ActiveUS20070083460A1Prevent theftMaximum anonymityFinanceDigital data protectionCredit cardEmail address

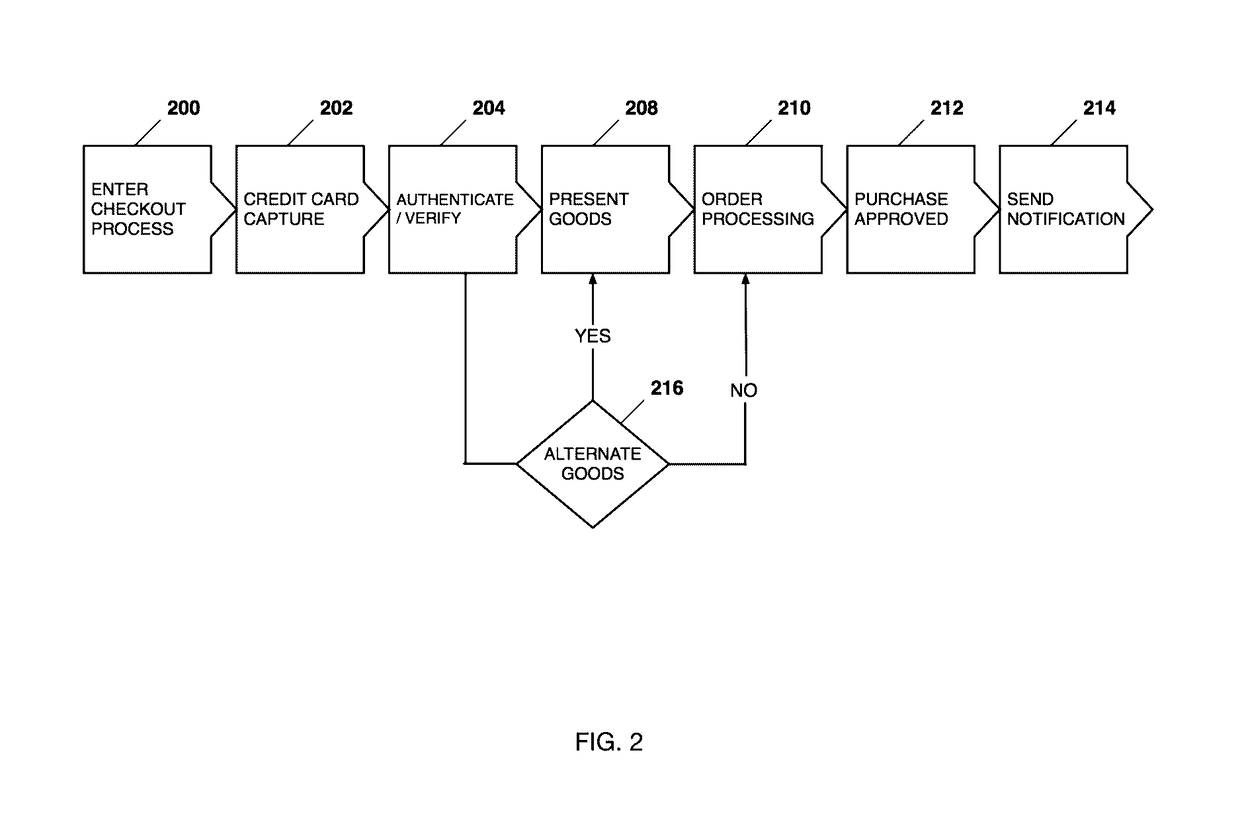

A system and method for preventing personal identity theft when making online and offline purchases requires a purchaser to first subscribe and become a member user by registering and providing relevant personal identity information. Once registered, the member is assigned a user name and a password. The subscribing member's personal identity information is then encrypted and stored at one or more highly secure locations. The ID protection system obtains a controlled use card (CUC) through a CUC issuer on behalf of the member for use to make each purchase transaction. The CUC is anonymous with respect to user (member) identity and may be a purchase-specific single-use card or a multiple-use stored value card with no traceable connection to any other financial account. When the member makes a secure online purchase, the system software enters anonymous information (i.e. not revealing the member's real name, email address, billing information, etc.) on the merchant's order placement screen, except in instances where the member's real identity information is required (e.g. airline tickets). The merchant receives the completed checkout screen, obtains credit approval through a credit card association, and sends the shipping information to a shipper which independently obtains the correct shipping name and address from the ID protection system prior to shipping the purchased product(s).

Owner:VIPR SYST +1

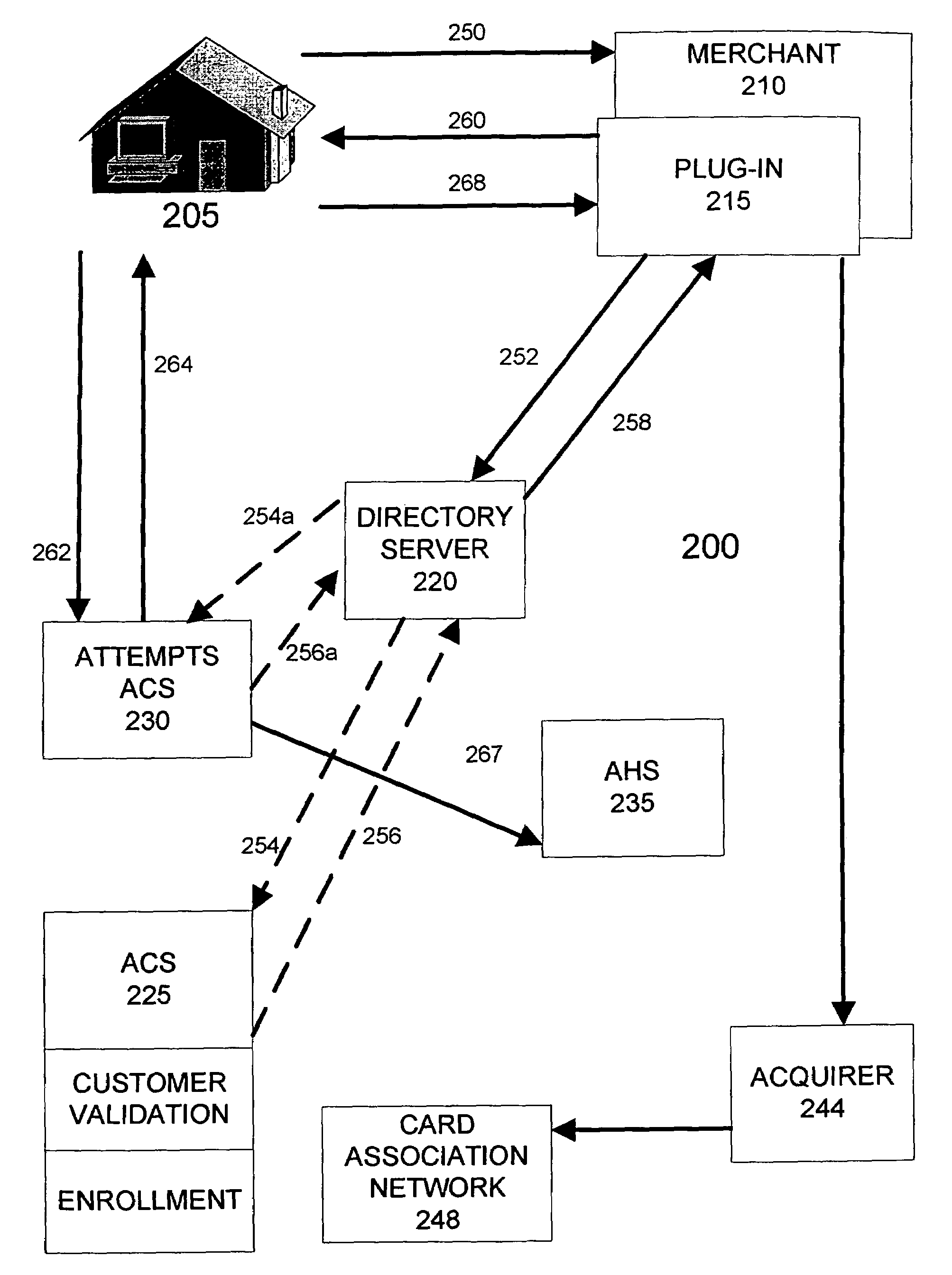

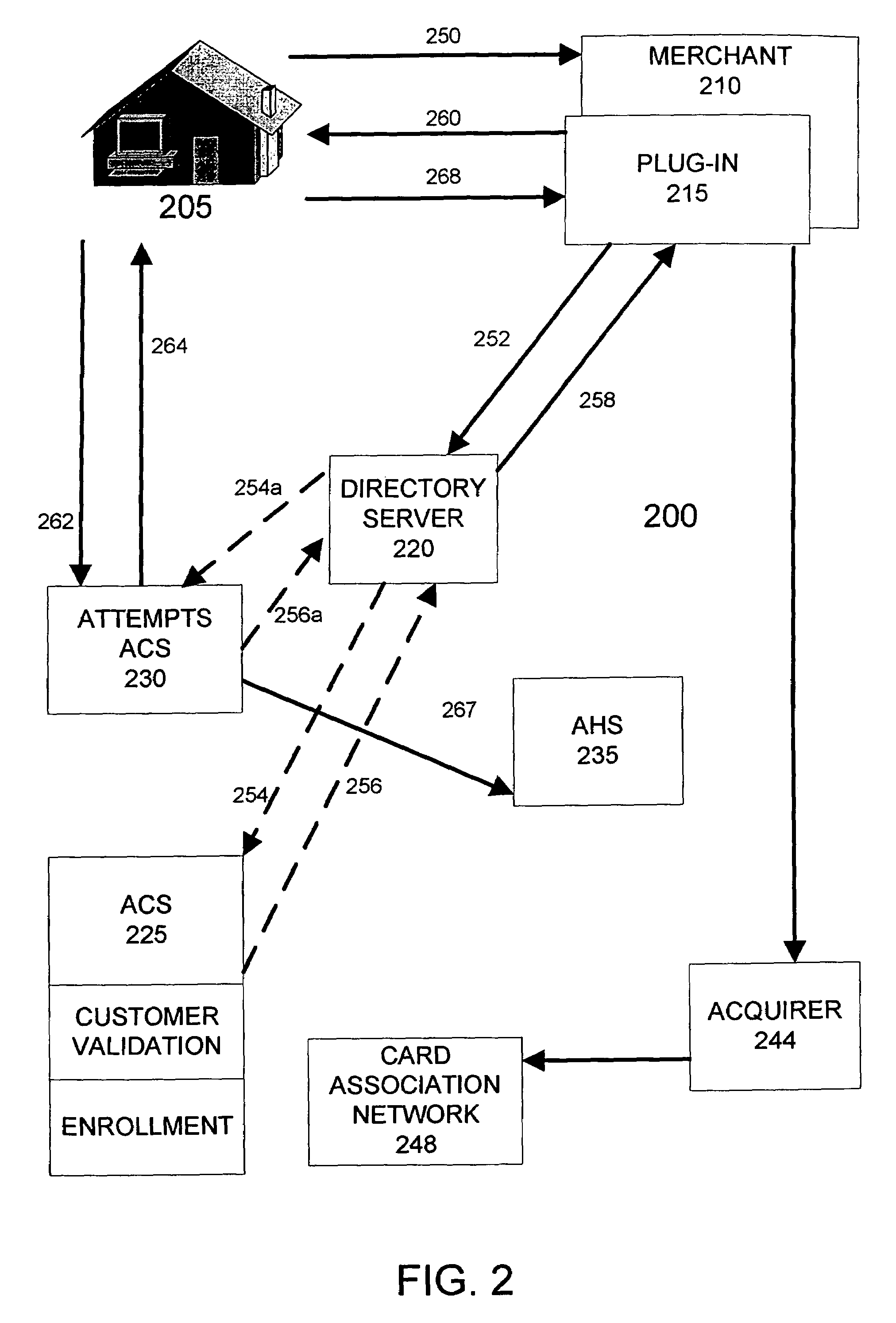

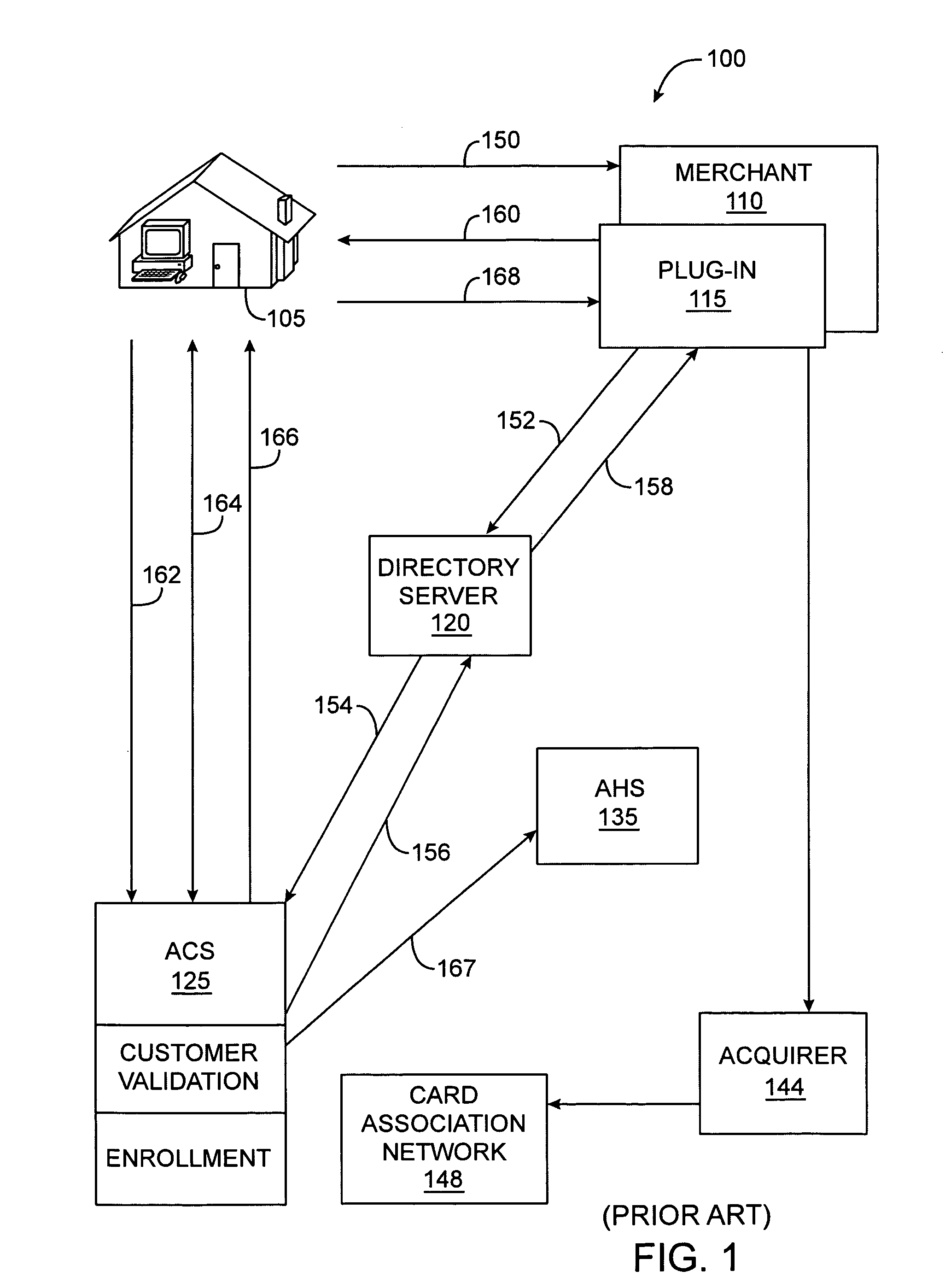

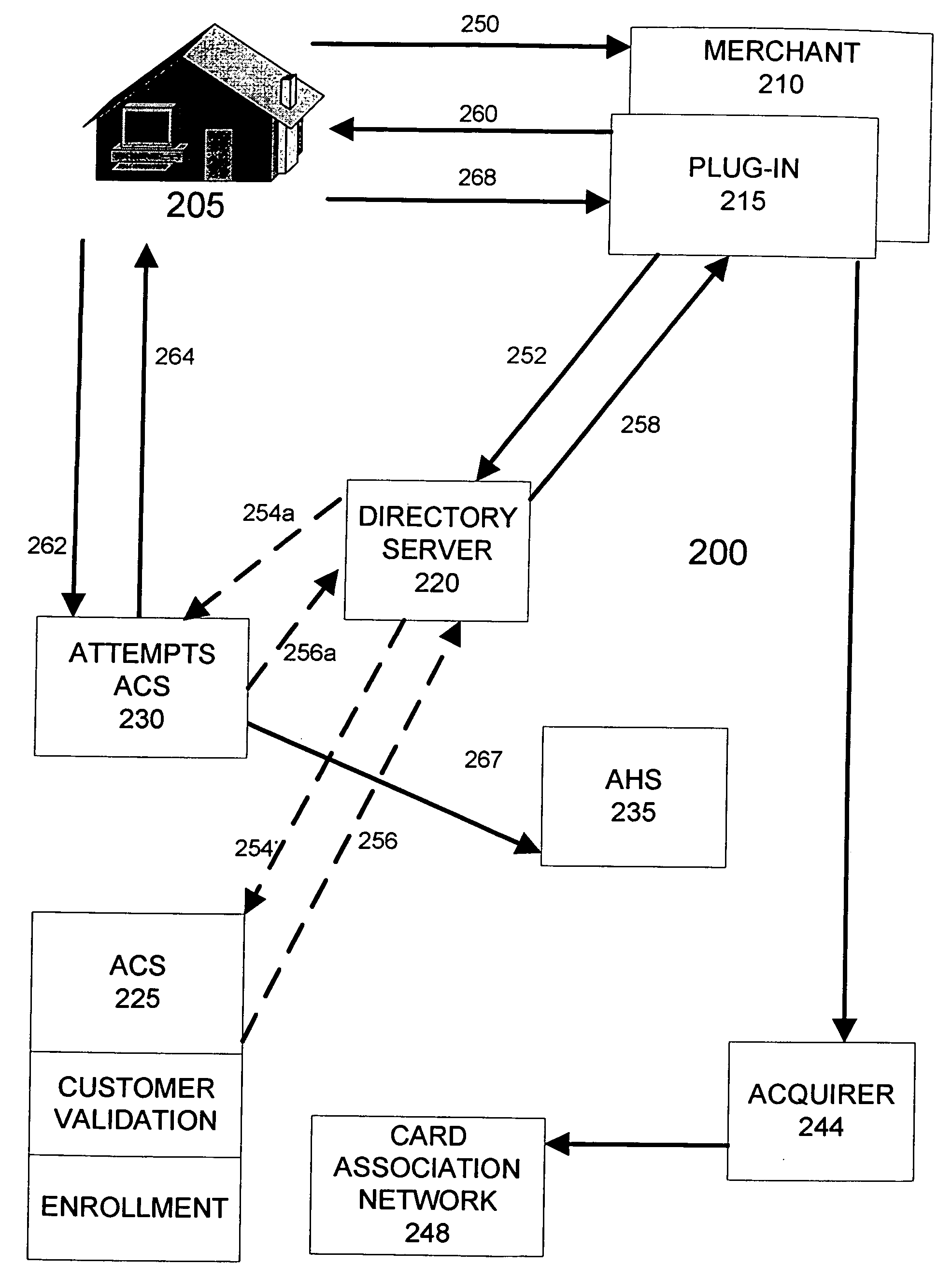

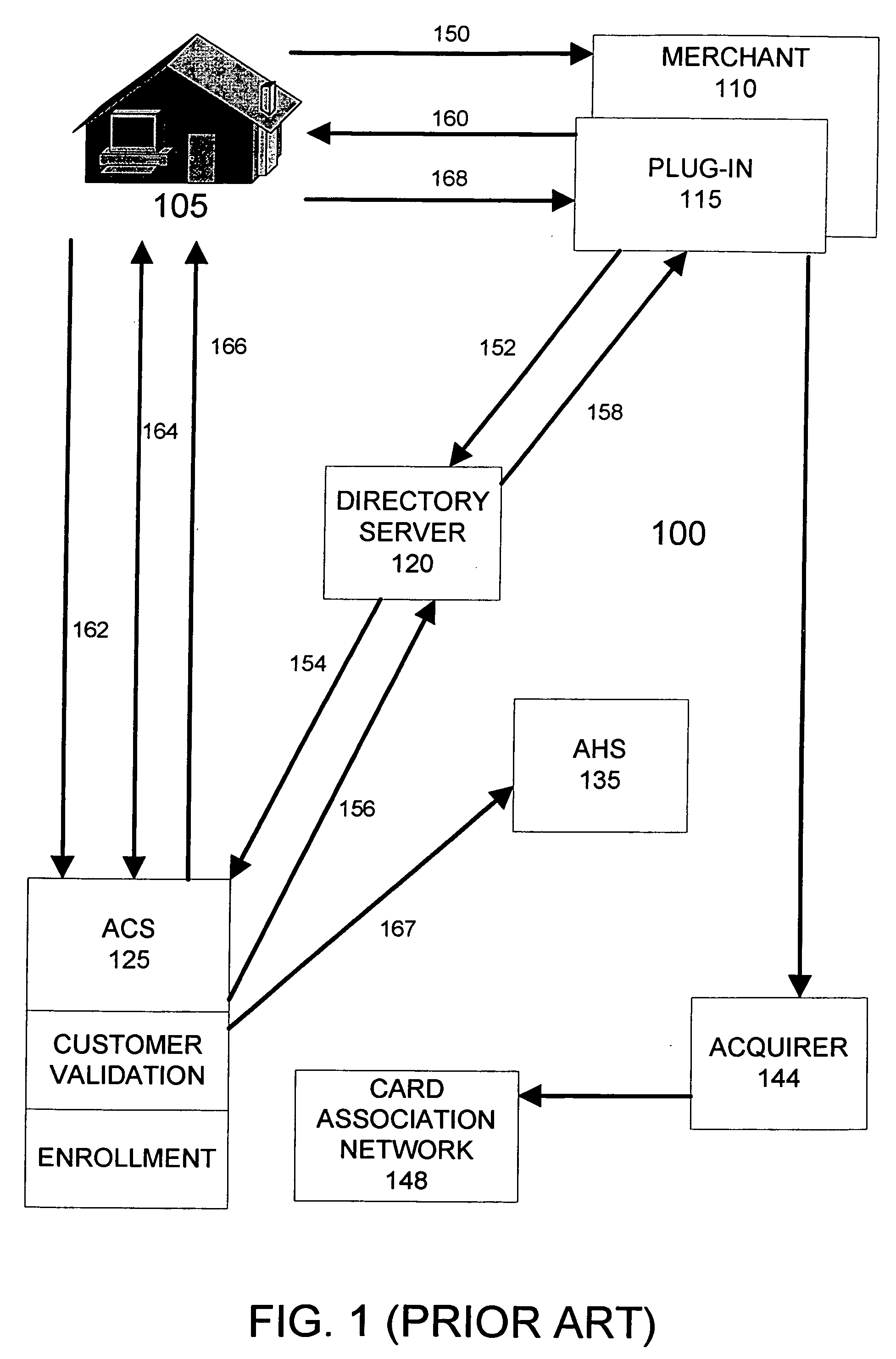

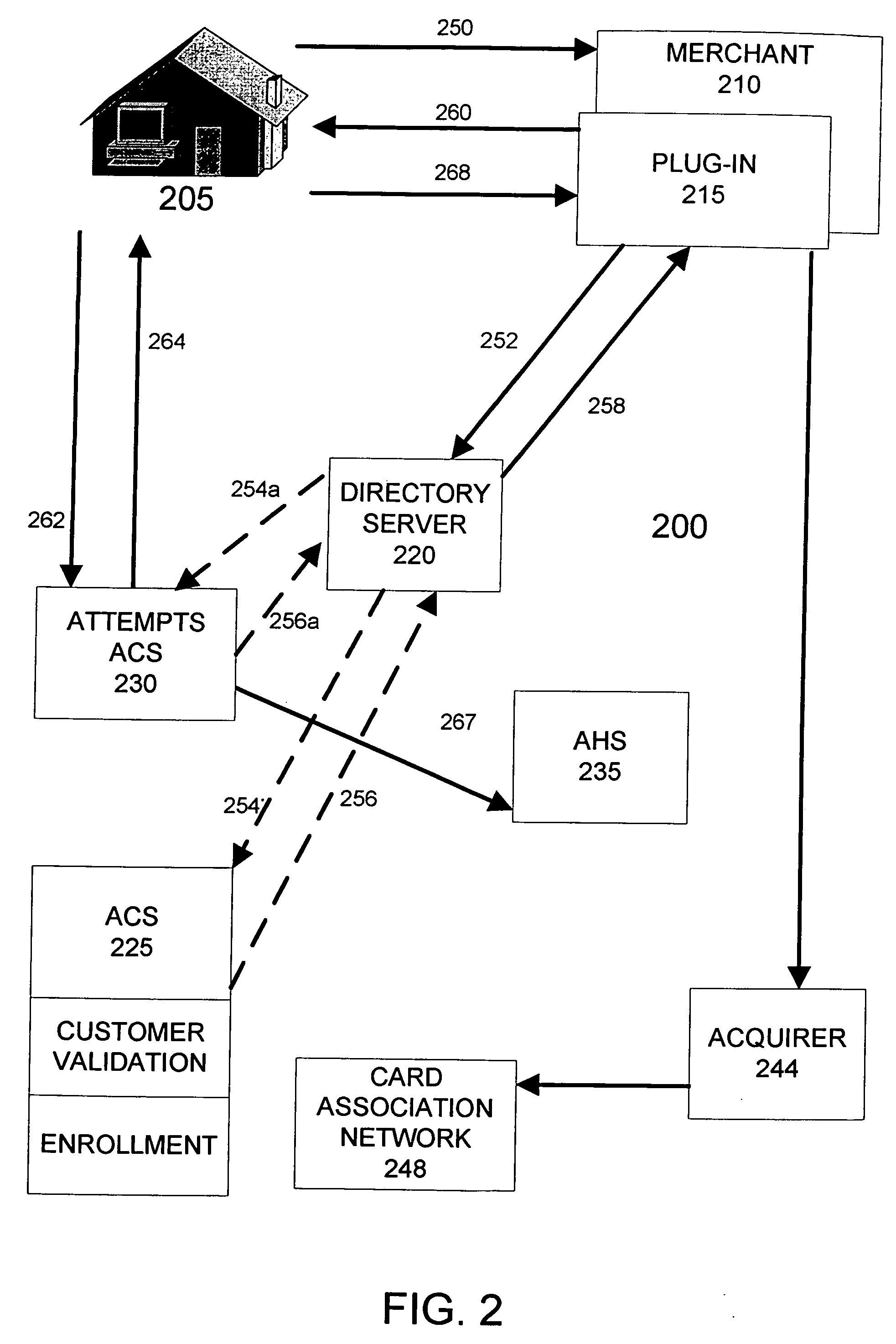

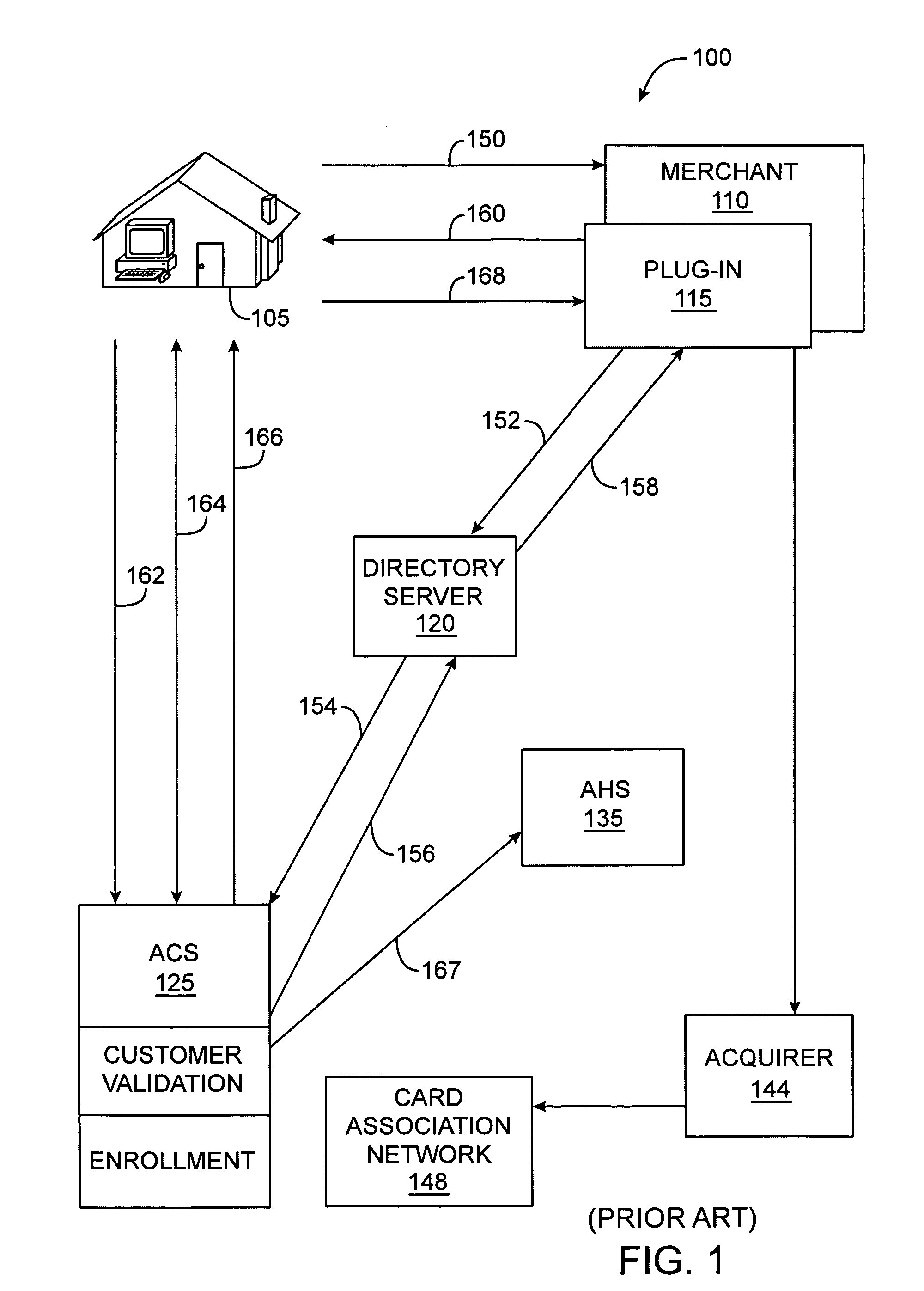

Managing attempts to initiate authentication of electronic commerce card transactions

To encourage widespread implementation of an electronic commerce card authentication system by the numerous different card issuers and merchants, the card association assigns liability for fraudulent transaction based upon a party's compliance with the authentication system. To enable this feature, an embodiment of the card processing system includes the ability to track and record attempts by merchants to initiate authentications, even in circumstances where the card issuer does not support authentication or can not authenticate the card information its receives. A directory server determines whether a card account is capable of being authenticated. If the card issuer cannot authenticate the card account, the directory server instructs the merchant system to attempt authentication with an alternate access control server. The alternate access control server is adapted to communicate an authentication response message with the merchant system indicating that the merchant system attempted an authentication.

Owner:VISA USA INC (US)

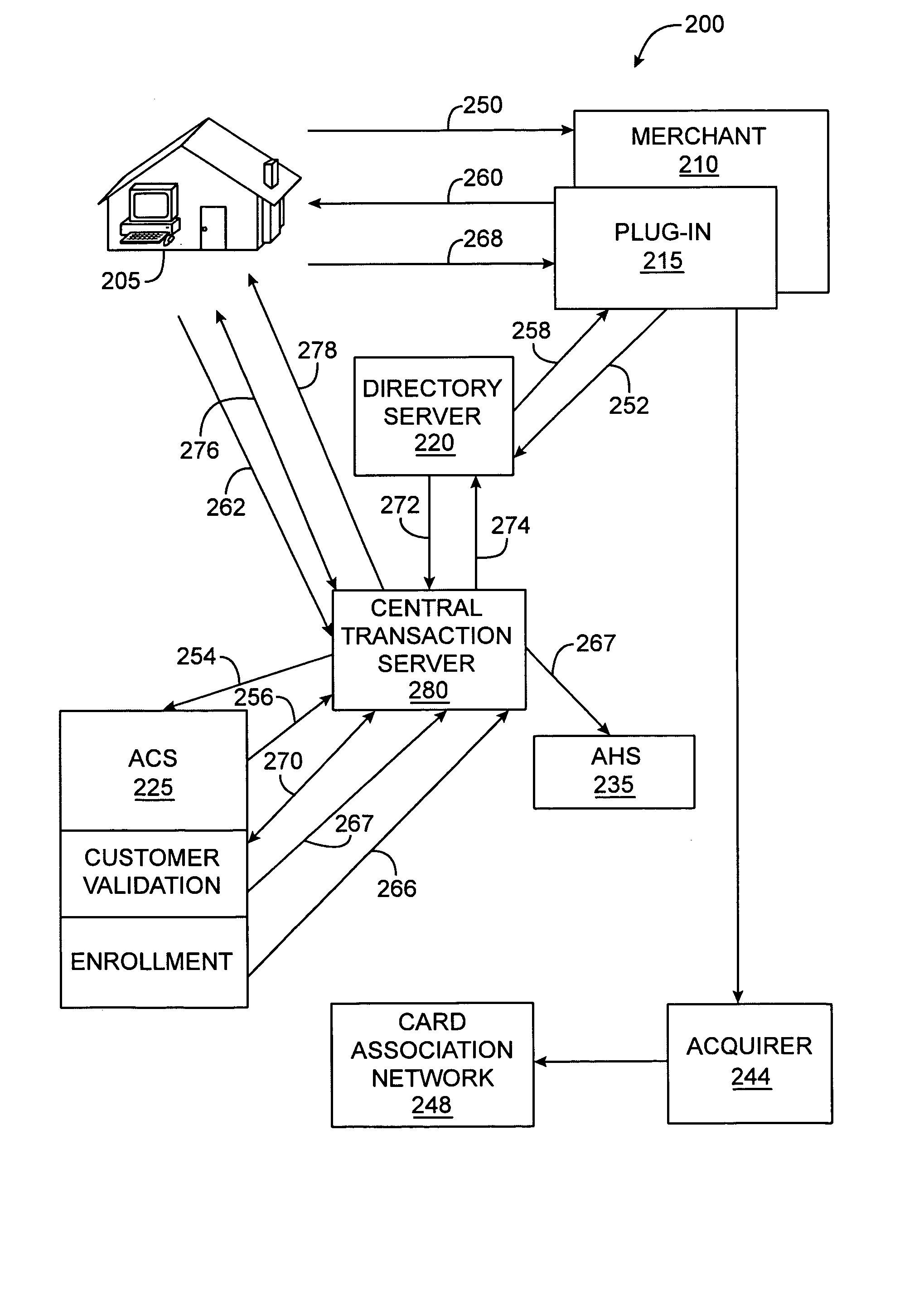

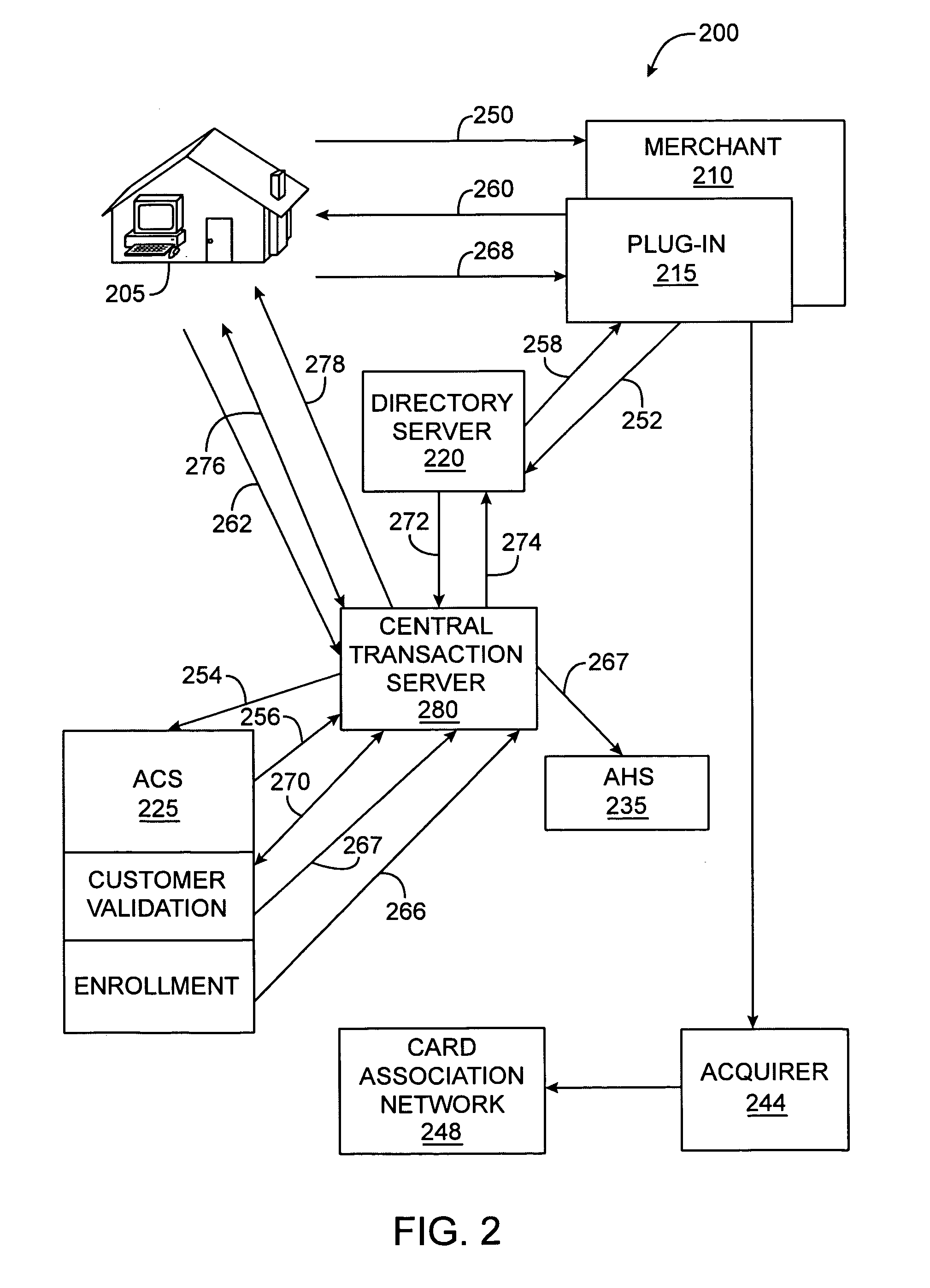

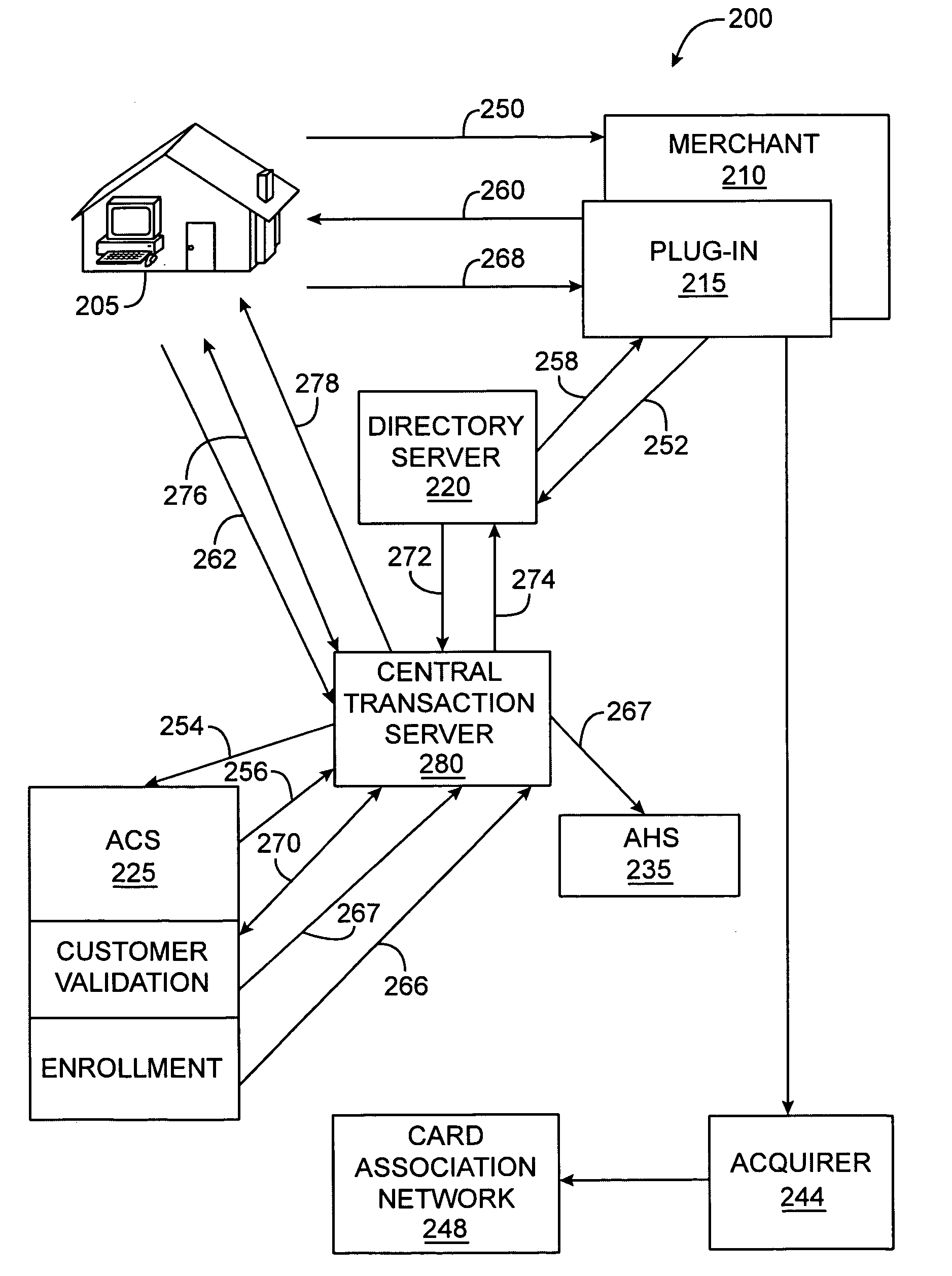

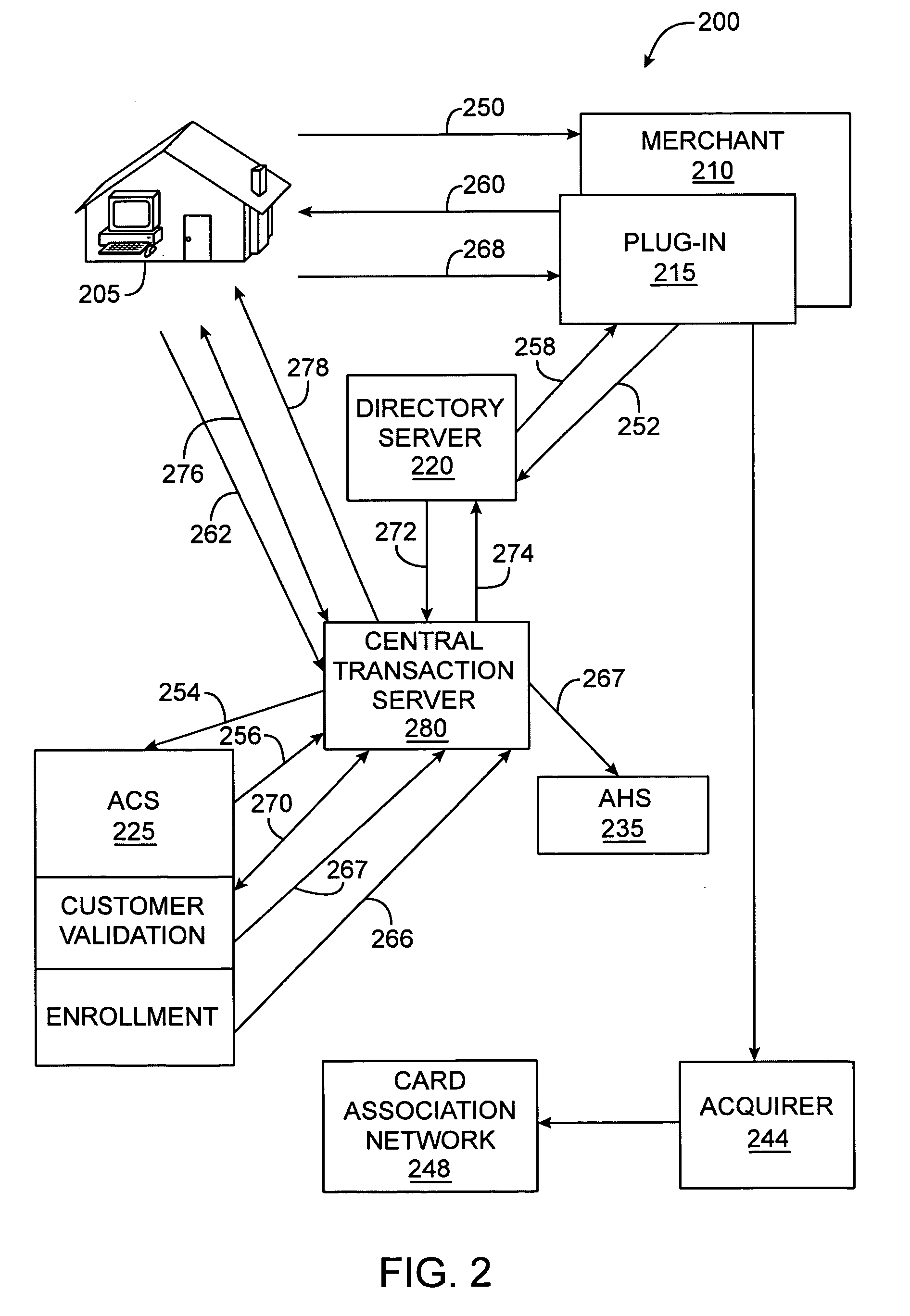

Centralized electronic commerce card transactions

A central transaction server in electronic commerce card authorization system enables the electronic commerce card association to manage and monitor the authentication system. The central transaction server acts as an intermediary for all communications between the access control server used for authentication. If any portion of the authentication system fails, the central transaction server compensates by providing appropriate responses to other portions of the system. The centralized transaction server translates all incoming traffic into a format compatible with the intended recipient, enabling portions of the system to be upgraded without breaking compatibility with the non-upgraded portions. The centralized transaction server also enables the integration of formally separate portions of the authentication system into a single unit. The directory and the authentication history servers can be integrated into the central transaction server, and the central transaction server can initiate charges to the electronic commerce card automatically, bypassing the card acquirer.

Owner:VISA USA INC (US)

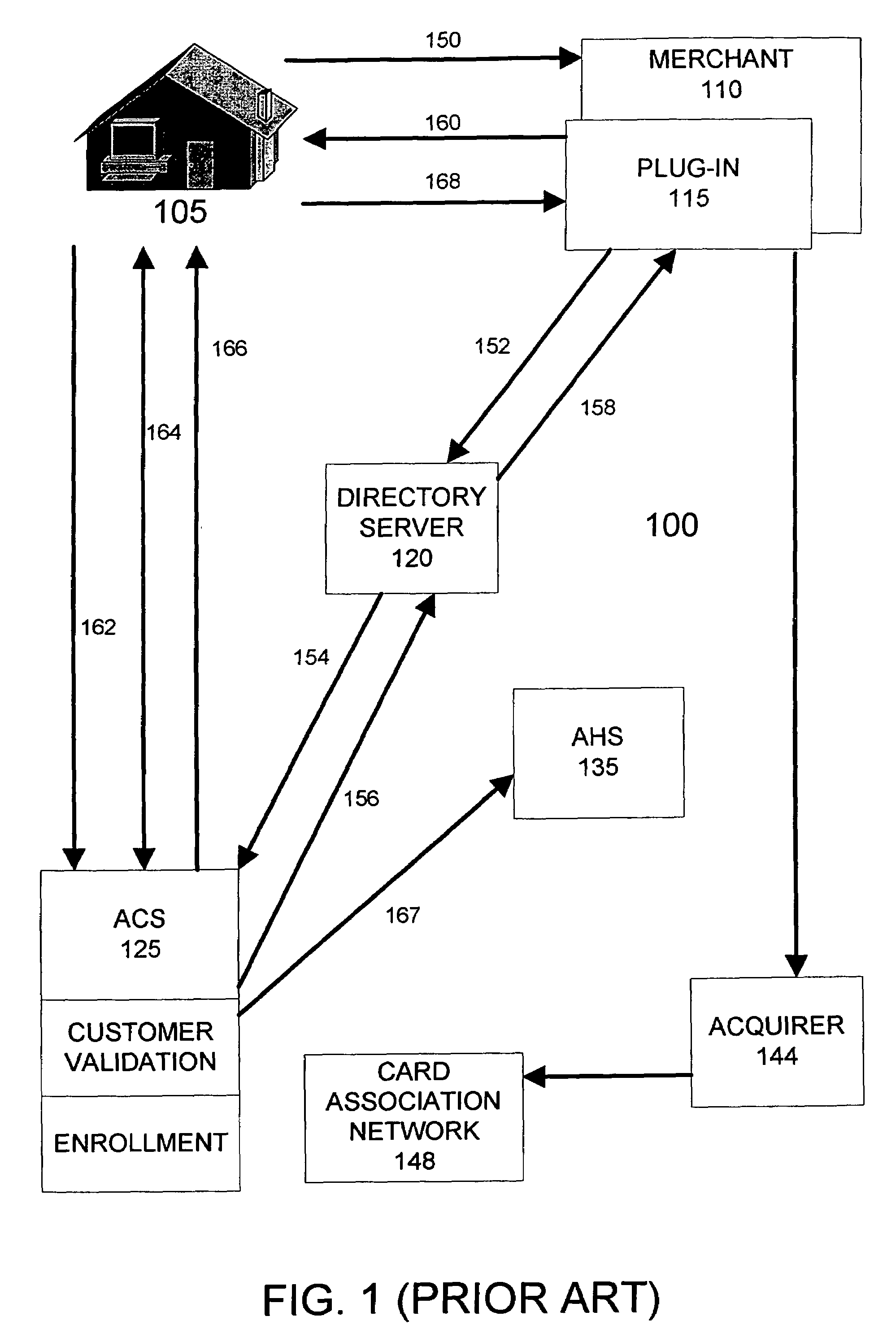

Managing attempts to initiate authentication of electronic commerce card transactions

To encourage widespread implementation of an electronic commerce card authentication system by the numerous different card issuers and merchants, the card association assigns liability for fraudulent transaction based upon a party's compliance with the authentication system. To enable this feature, an embodiment of the card processing system includes the ability to track and record attempts by merchants to initiate authentications, even in circumstances where the card issuer does not support authentication or can not authenticate the card information its receives. A directory server determines whether a card account is capable of being authenticated. If the card issuer cannot authenticate the card account, the directory server instructs the merchant system to attempt authentication with an alternate access control server. The alternate access control server is adapted to communicate an authentication response message with the merchant system indicating that the merchant system attempted an authentication.

Owner:VISA USA INC (US)

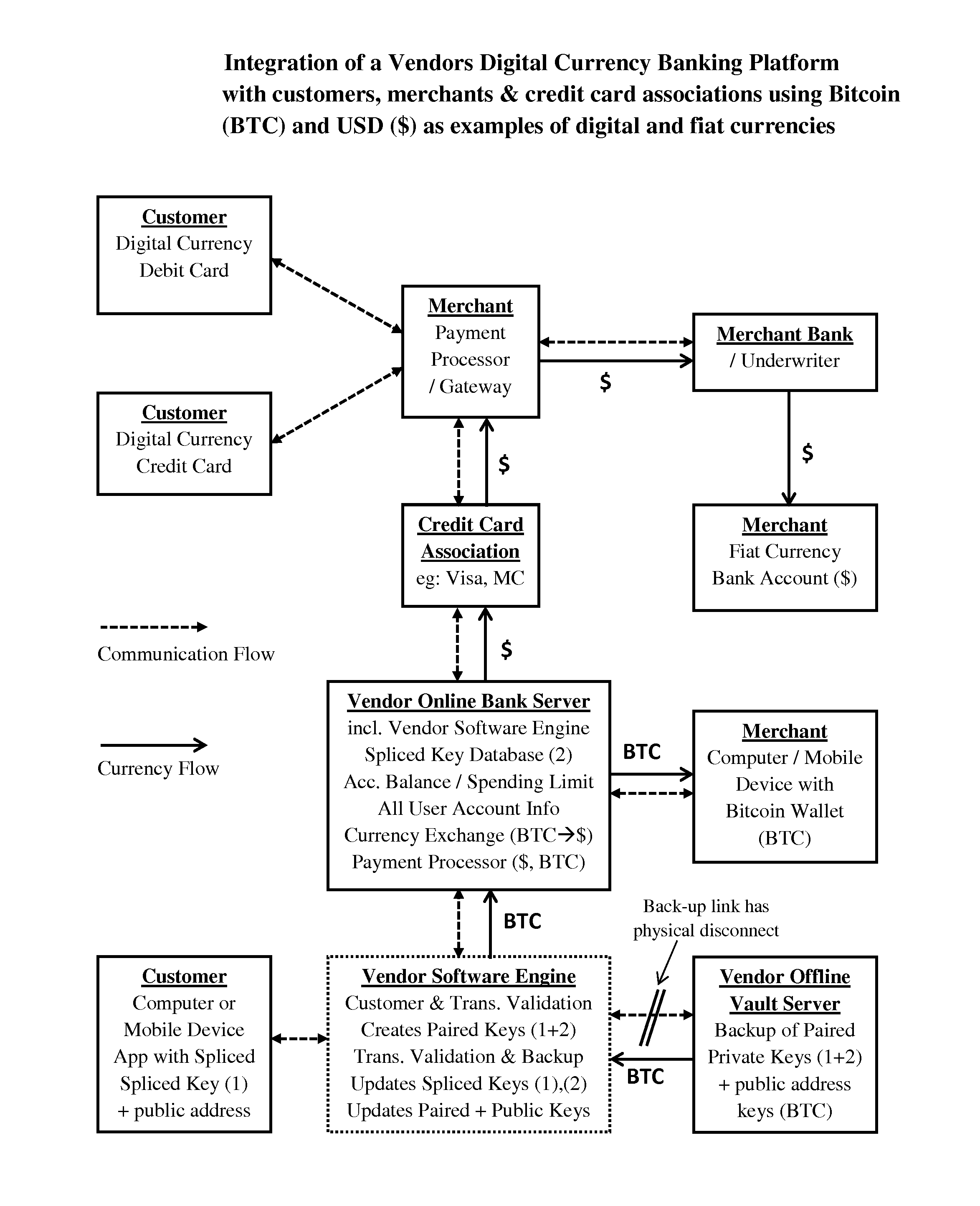

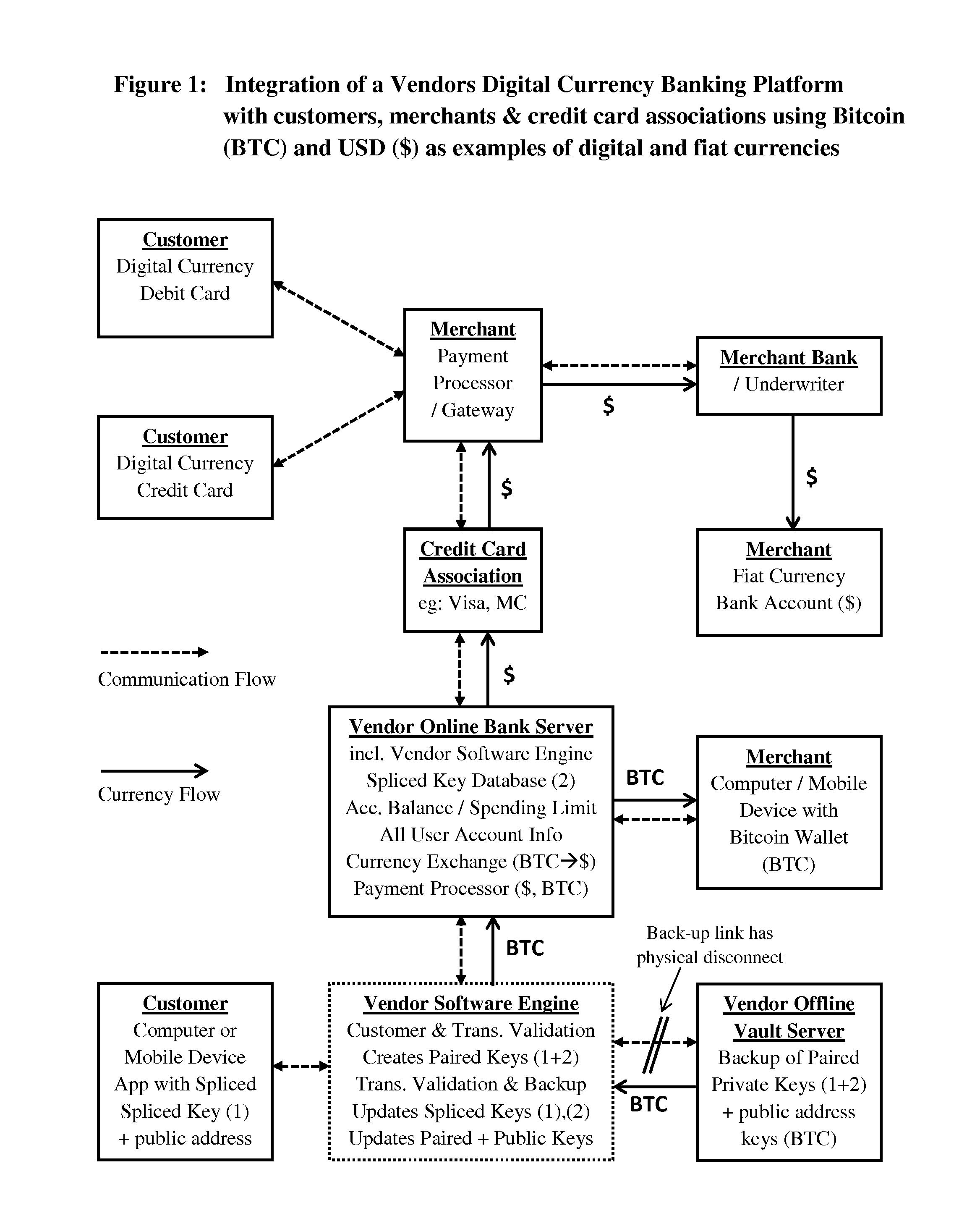

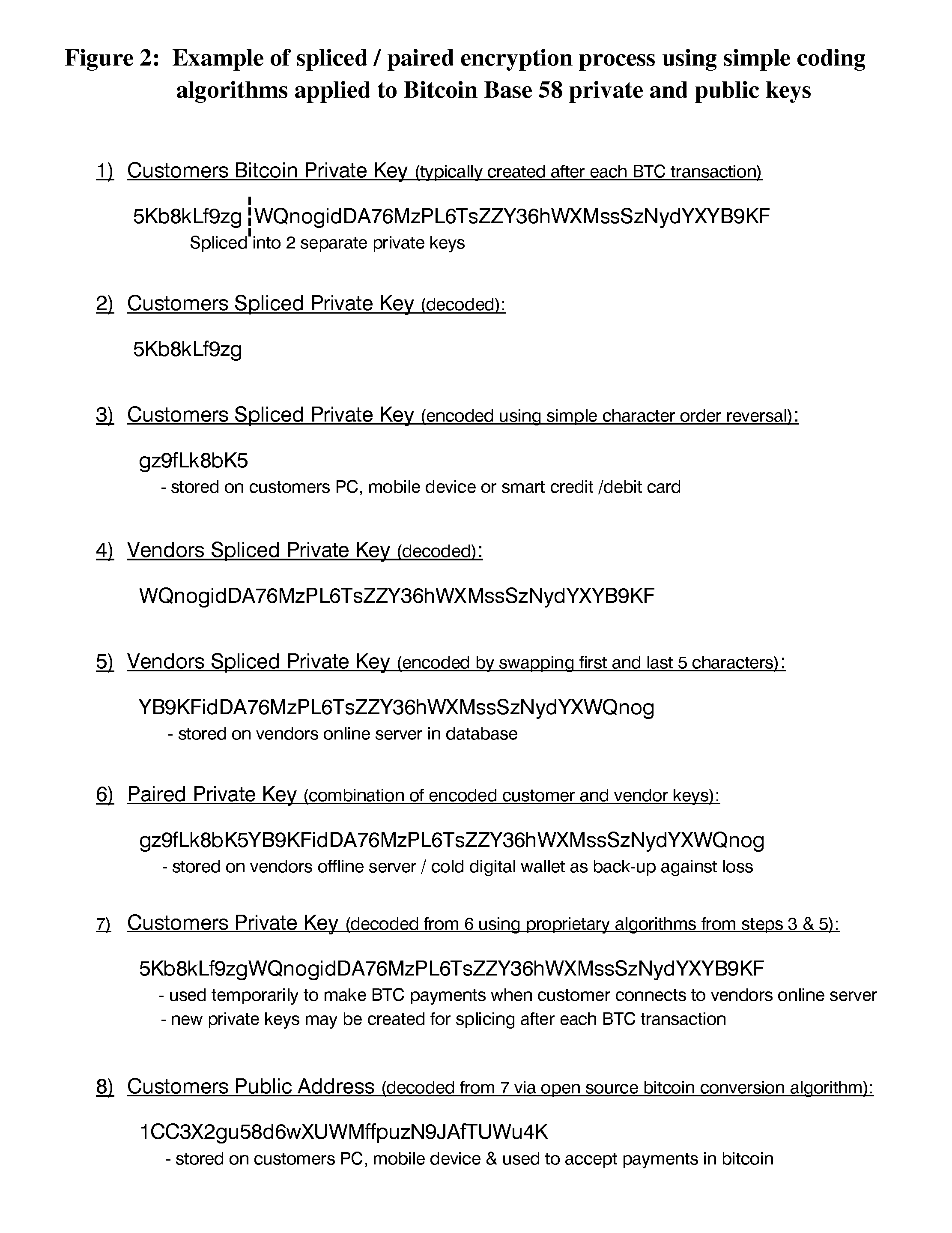

System and method for digital currency storage, payment and credit

InactiveUS20160335628A1Improved credit/debit card security benefitIncreased level securityComputer security arrangementsPayment protocolsDigital currencyStorage security

A system and method for the secure online storage of digital currency or crypto-currency assets, and the secure use of stored online digital currency assets for financial payment transactions and credit lending transactions in either digital currency or fiat currency. The present invention includes various methods for the encryption and secure online storage of a digital currency wallet using spliced / paired design architecture, and various methods for the integration of secure digital currency online wallets with online banking platforms, debit card devices, credit card devices, credit lending networks, merchant payment processors and credit card associations. The present invention also relates to the use of spliced / paired design architecture for non-financial applications that improve the online storage security of other types of data files and document files that are not related to digital currency or financial transactions.

Owner:CRYPTYK INC

Time-Of-Transaction Foreign Currency Conversion

InactiveUS20100145744A1Improve conversion rateComplete banking machinesFinanceCredit cardIssuing bank

Owner:PLANET PAYMENT

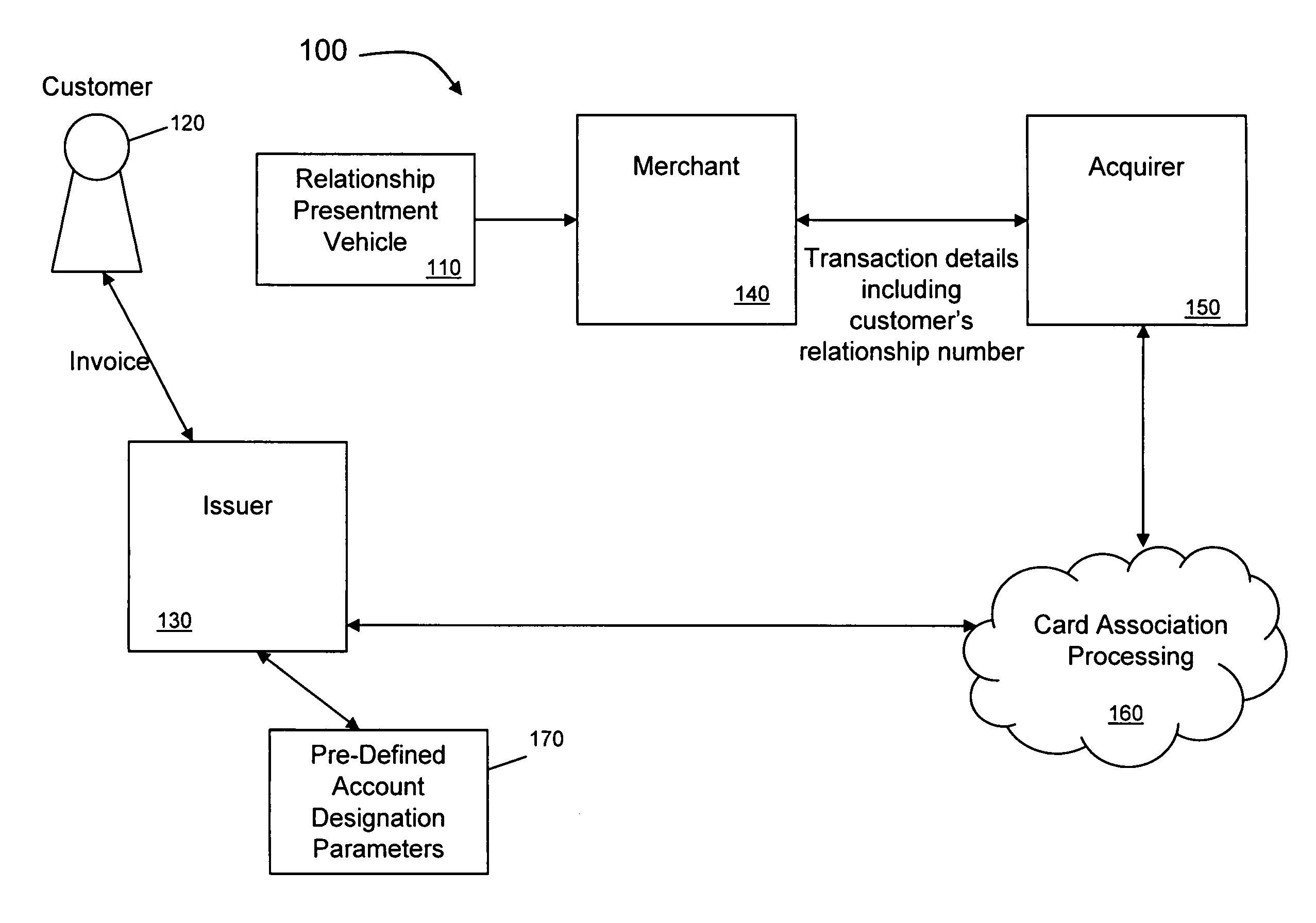

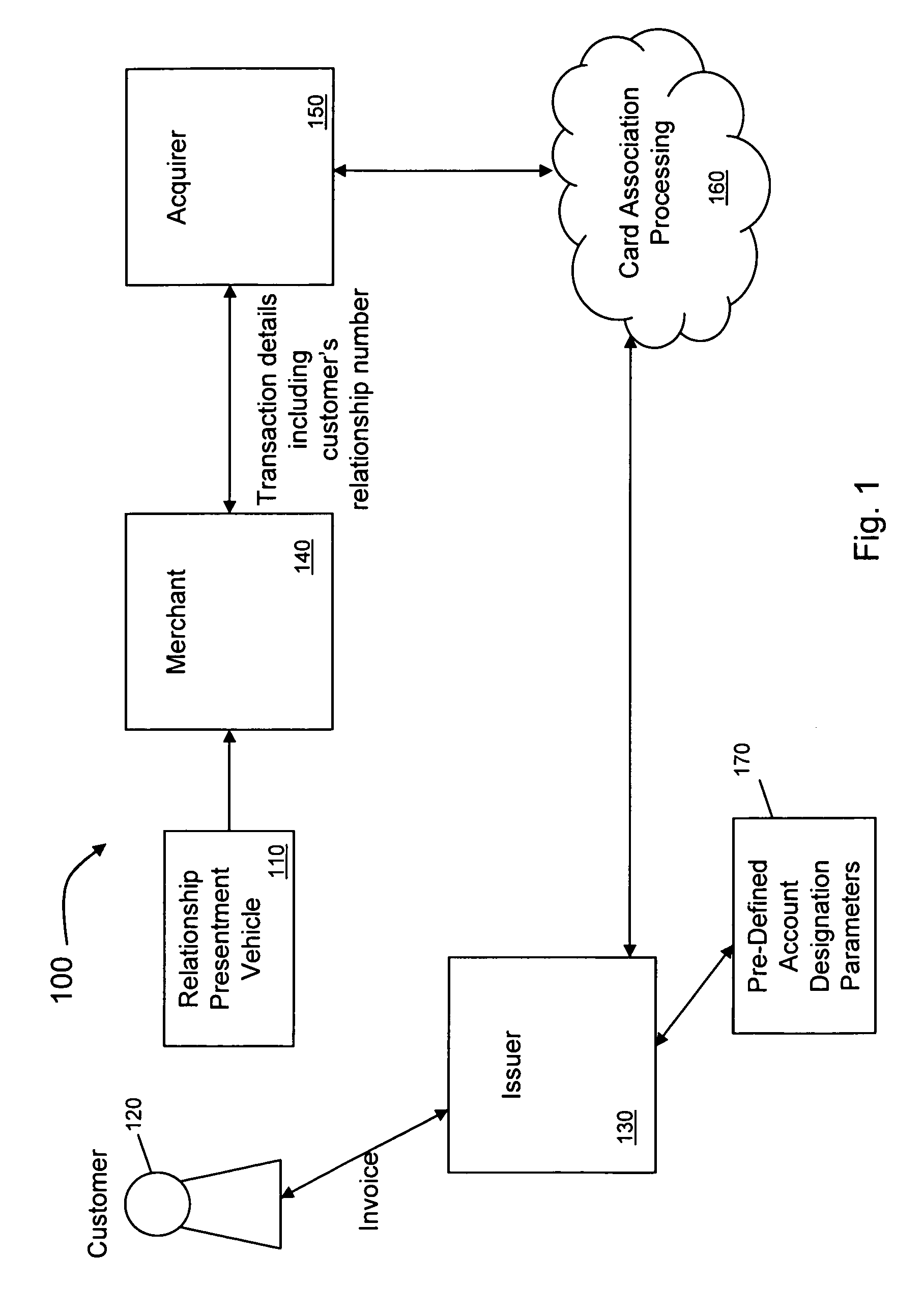

Methods and systems for managing financial institution customer accounts

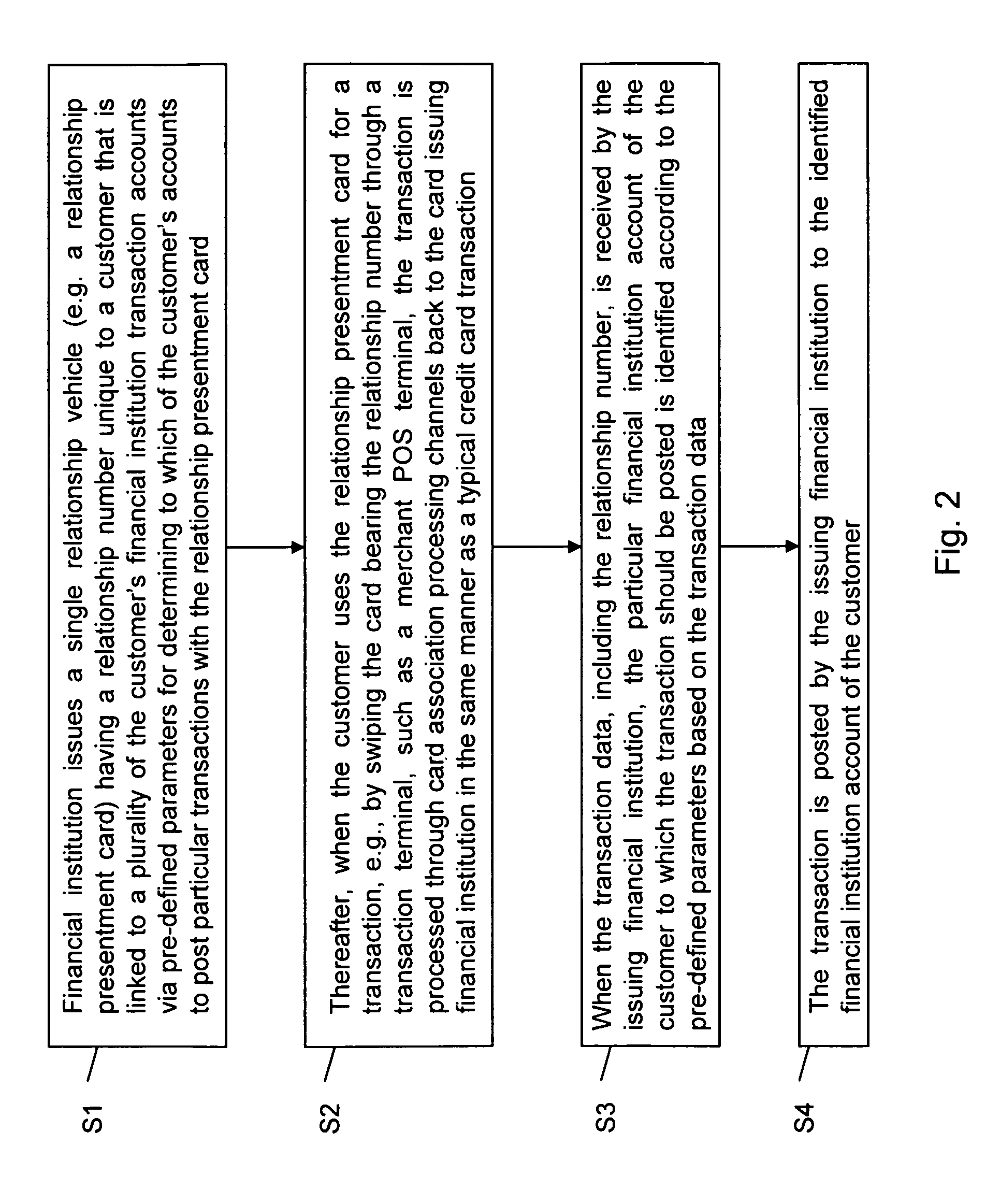

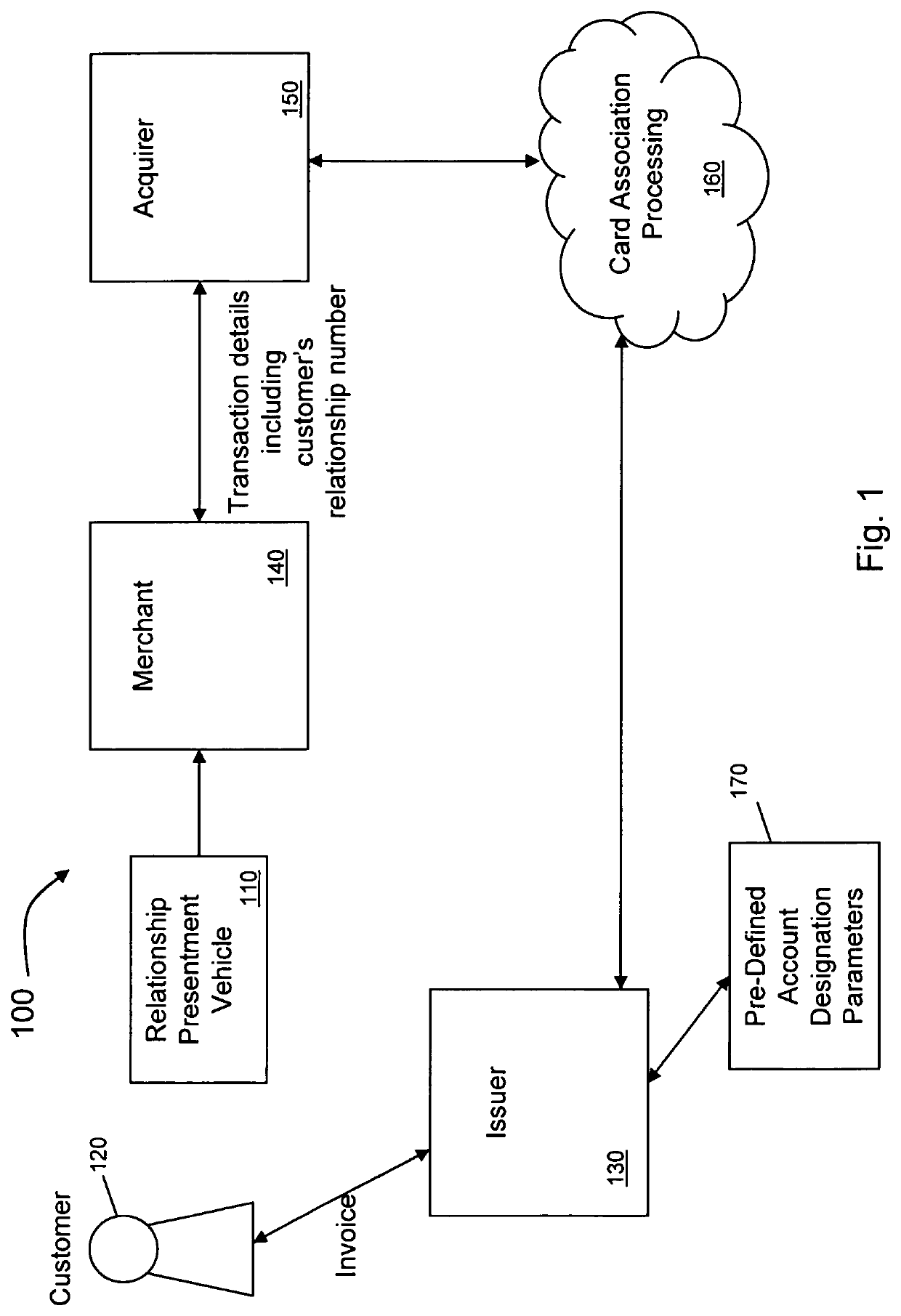

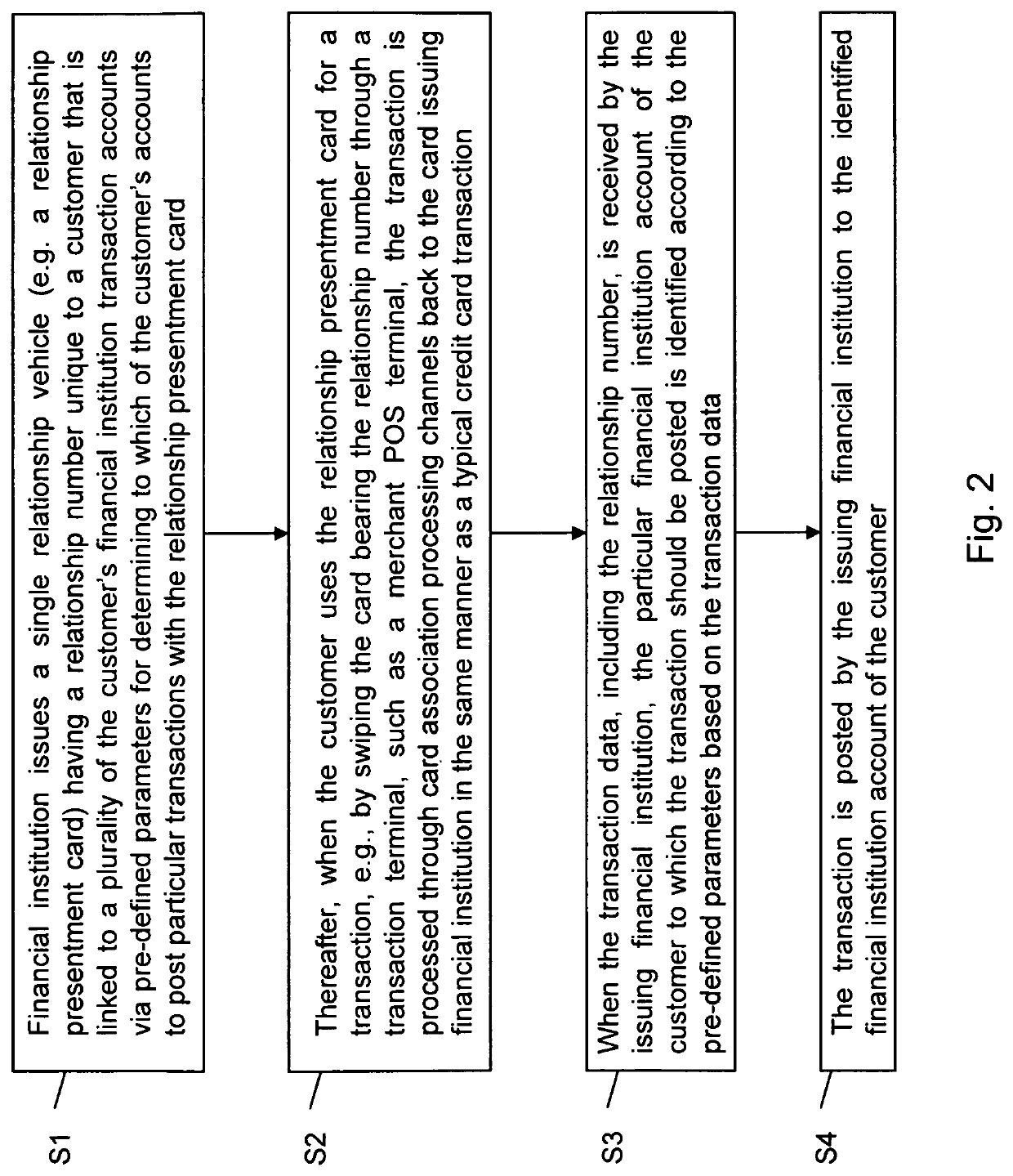

A computer-implemented method and system for managing financial institution customer transaction accounts involves issuing a relationship presentment card with a relationship identifier unique to the customer that is linked to a plurality of the customer's financial institution transaction accounts via pre-defined parameters for determining to which of the customer's linked accounts to post particular transactions with the relationship presentment card. Thereafter, when data for a transaction with the card is received by a processing platform of the financial institution via a merchant acquirer and a card association processing network, the card processing platform of the financial institution identifies a particular financial institution account of the customer to which the transaction should be posted according to the pre-defined parameters based on the transaction data and posts the transaction to the identified financial institution account of the customer.

Owner:CITICORP CREDIT SERVICES INC (USA)

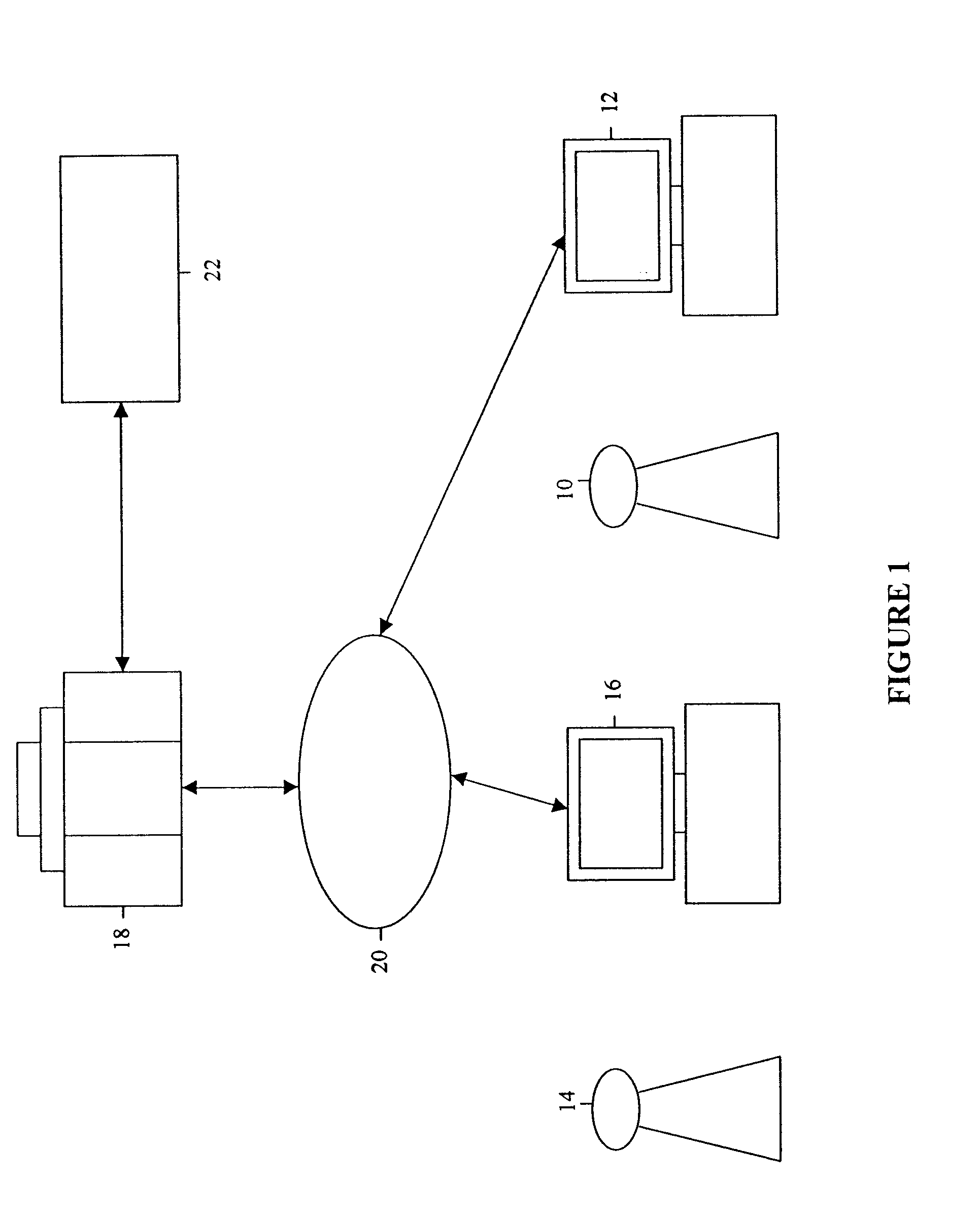

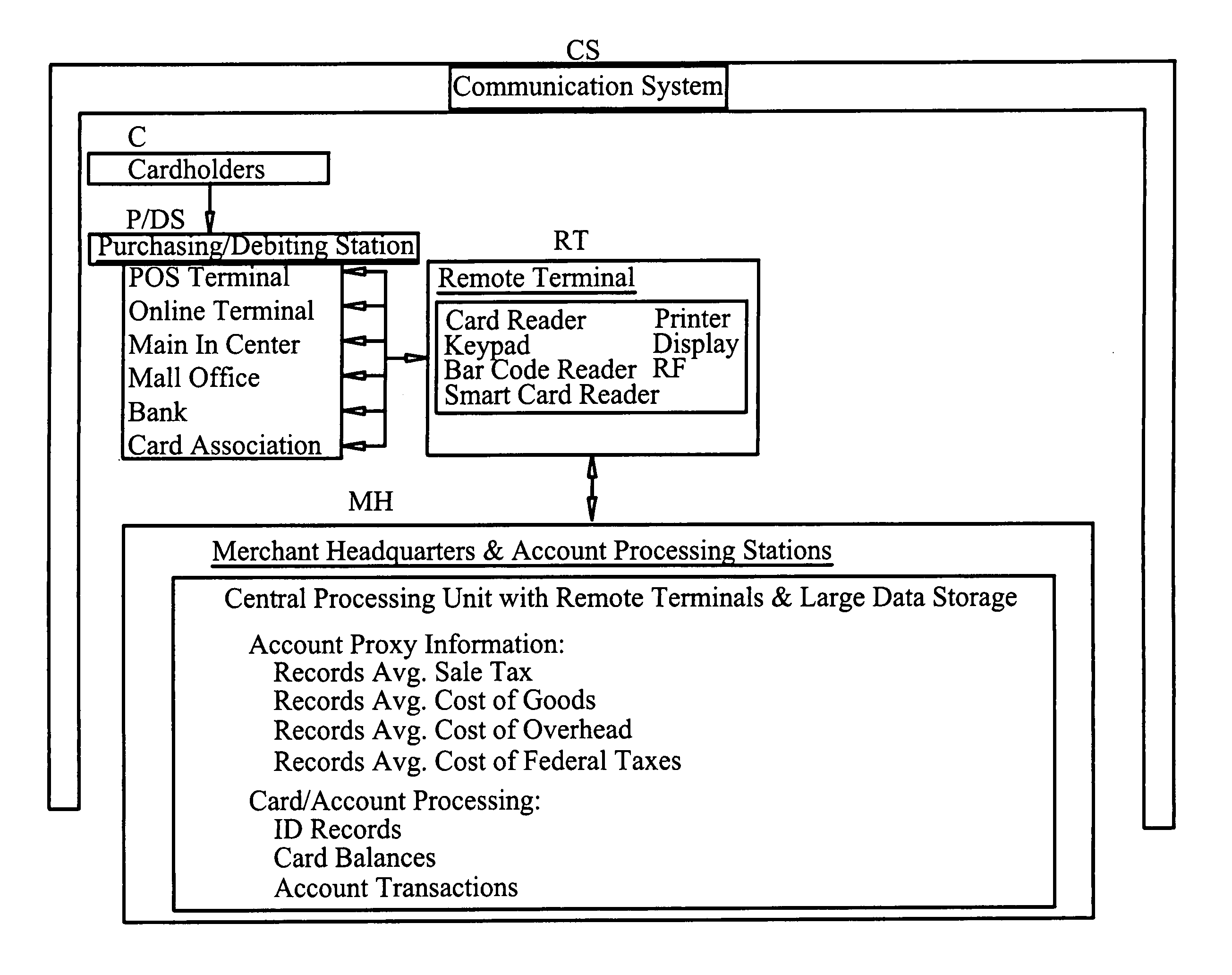

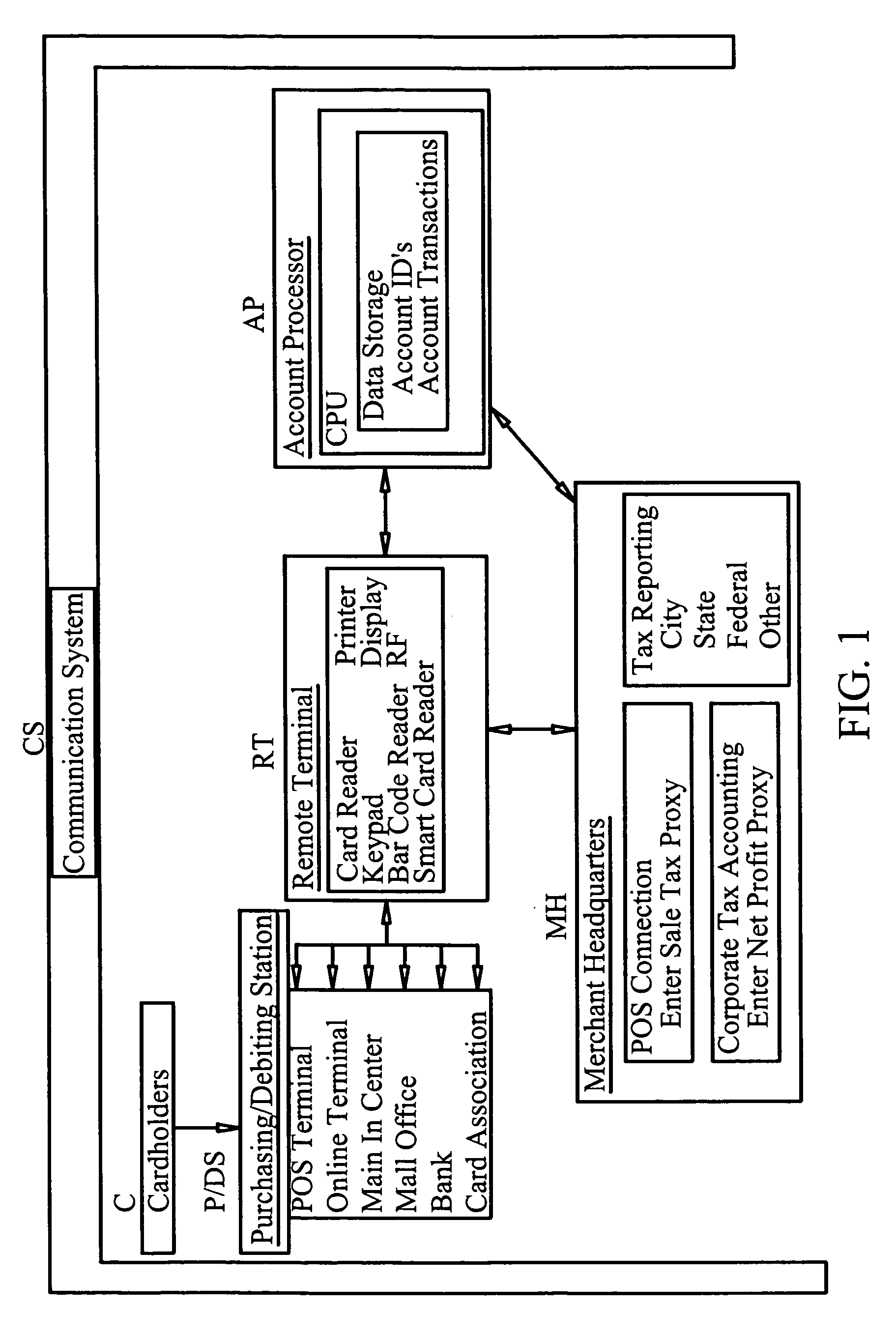

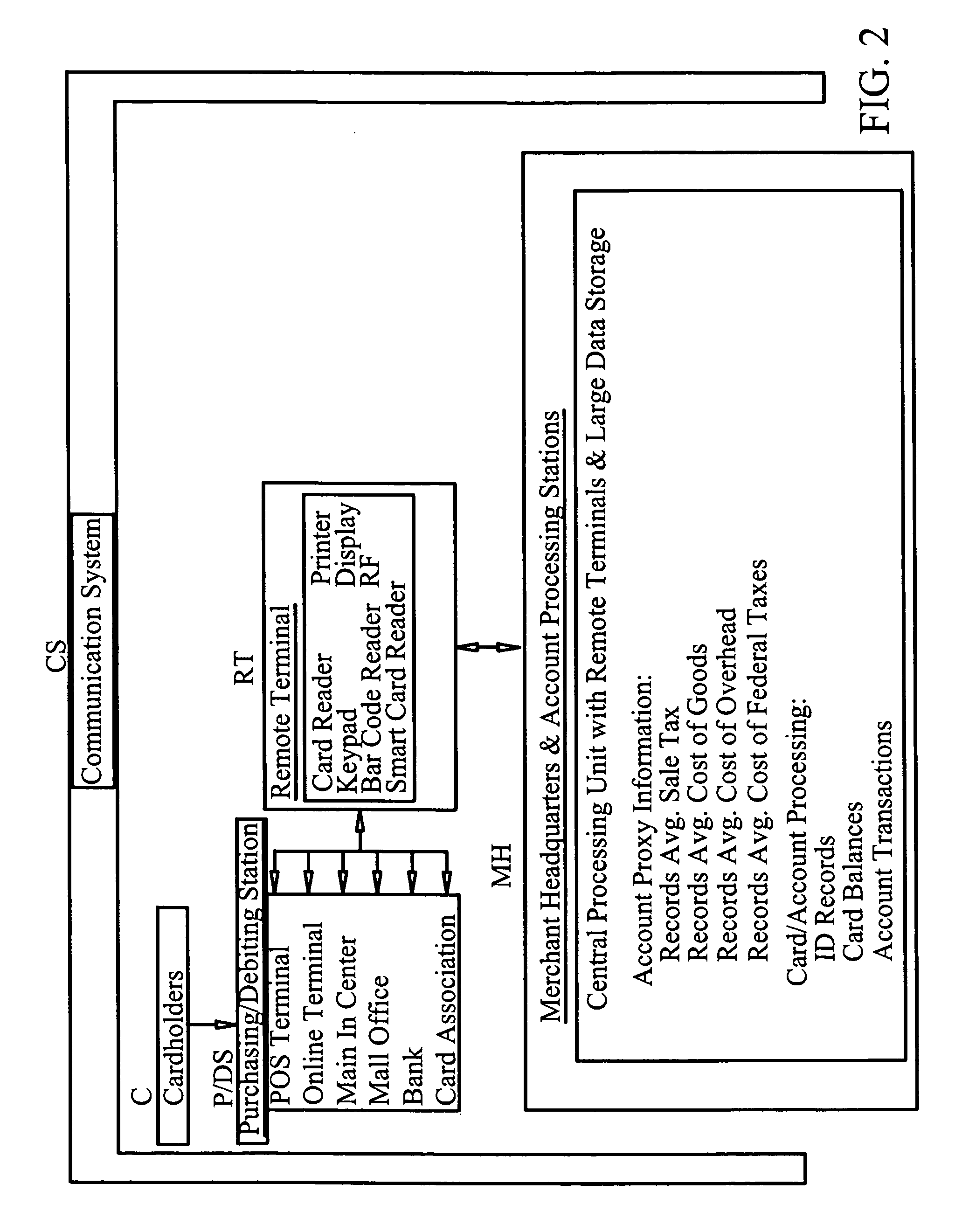

Final sale merchandise card

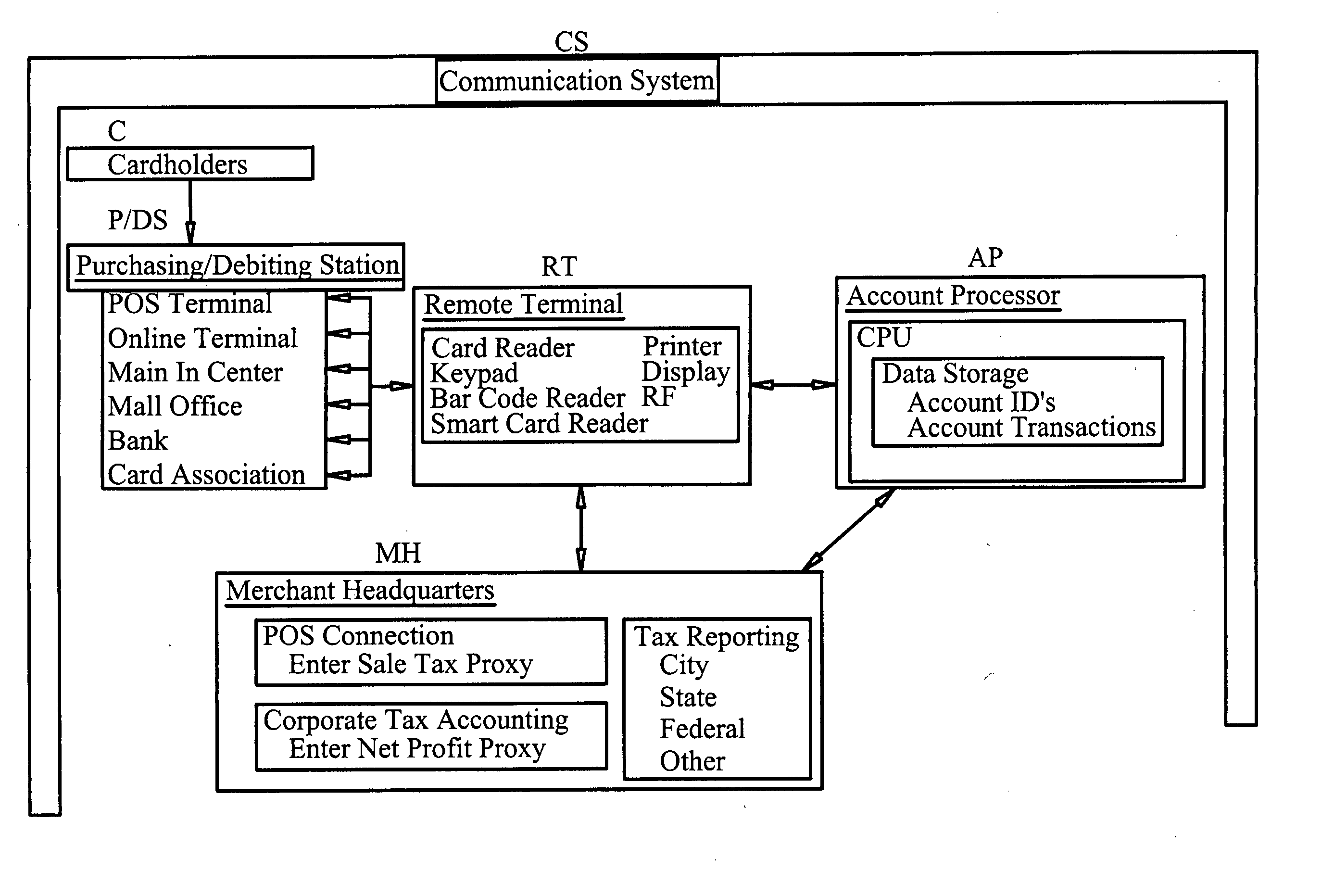

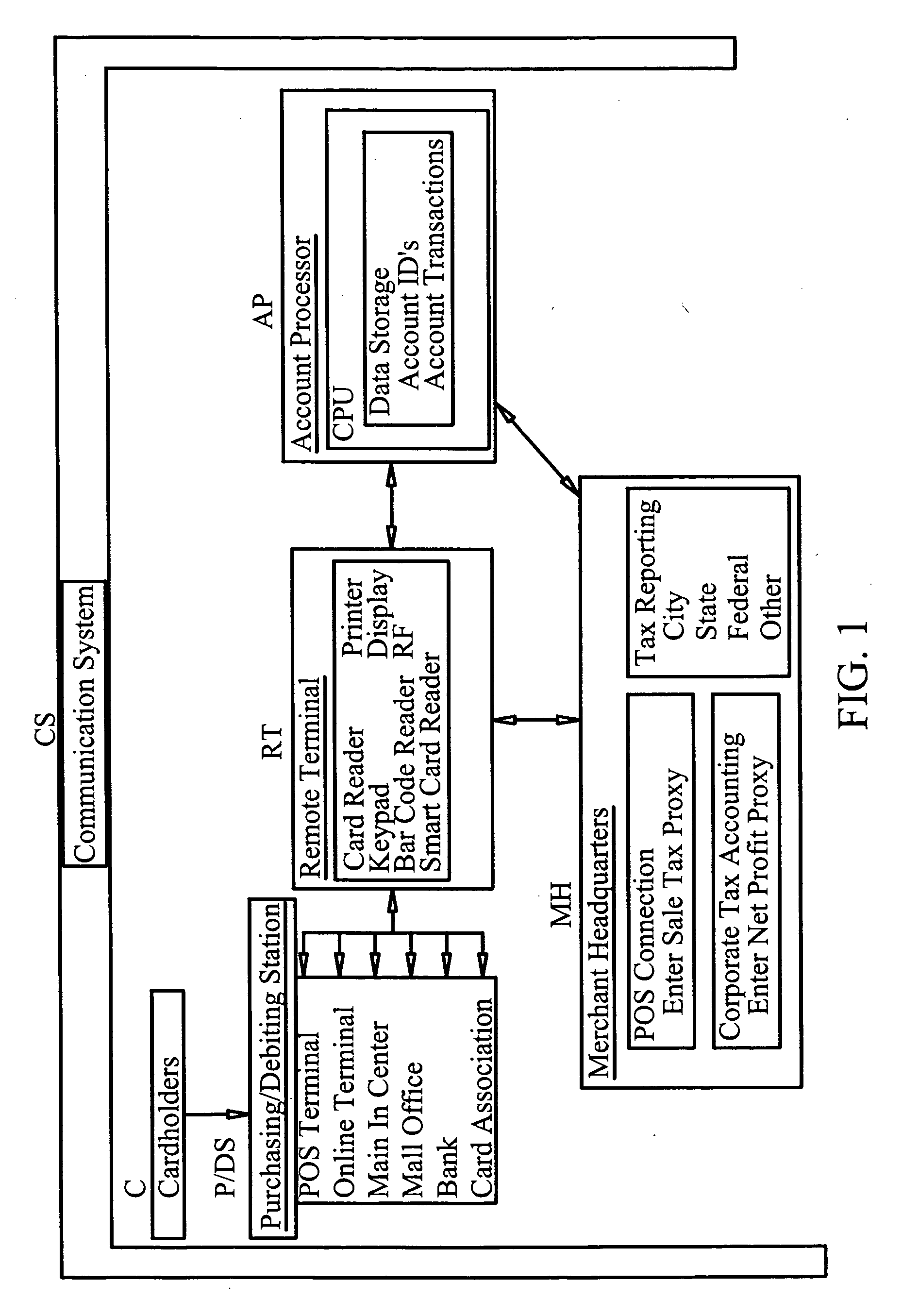

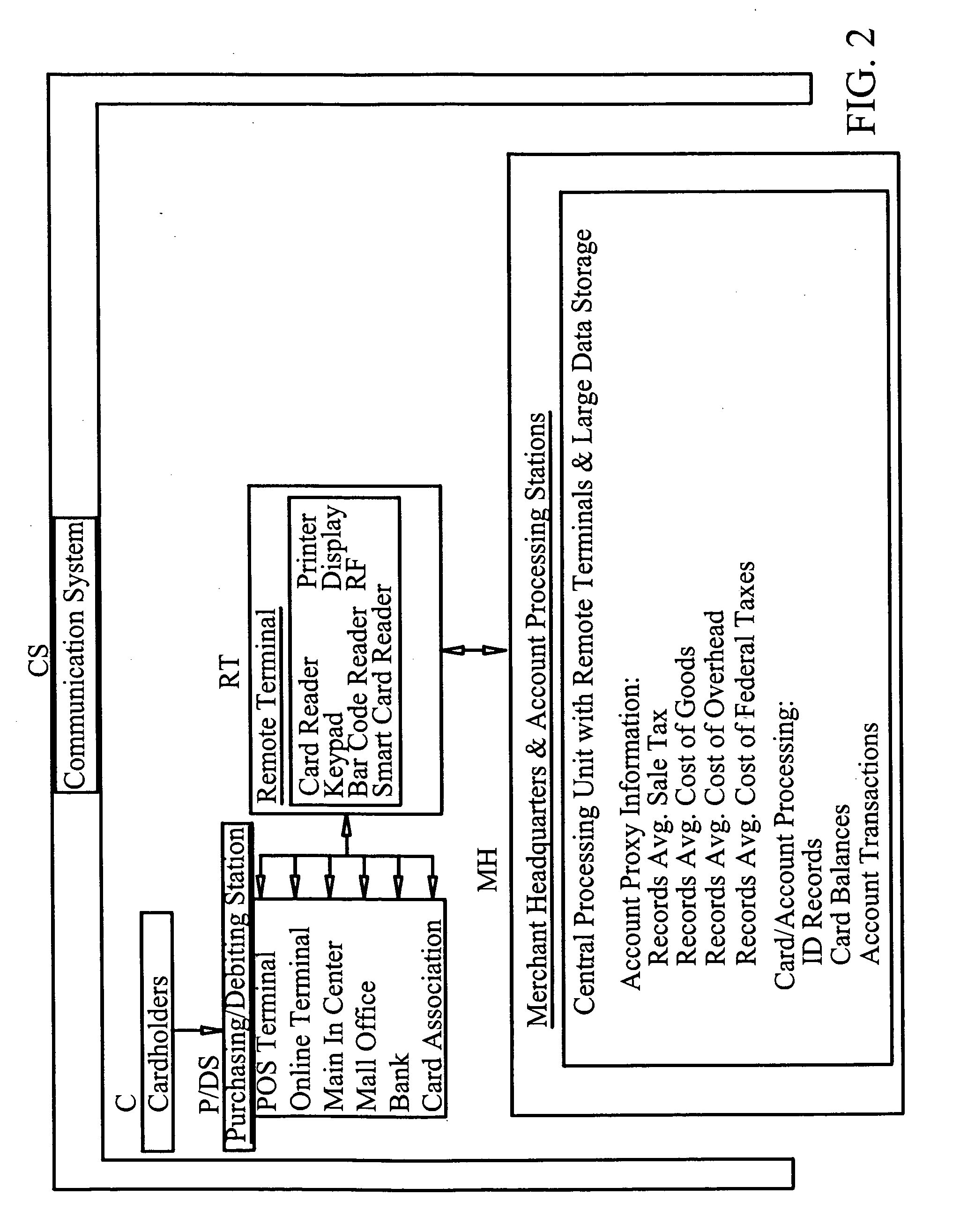

A system for activating a merchandise card and account that permits a card user to initially purchase or reload cash value into a merchandise account using a card issued by an issuer such as a merchant, bank, or card association via a terminal, with or without a PIN, and have the cash value on the card immediately converted to a purchase of proxy merchandise offered by the card issuer, and at the time of account debiting allowing said cardholder to make a final selection of merchandise from the inventory of the issuing merchant. The system operates a network, on a real time or batch basis, that uses a communication system to connect point of sale terminals, remote terminals, and computers operated by card issuers, merchant headquarters, and account processors to issue cards, calculates taxes and merchant costs, converts cash to proxy merchandise, and allows cardholders at the time of debiting their account to substitute the proxy purchase for a final selection of merchandise.

Owner:EVERY PENNY COUNTS

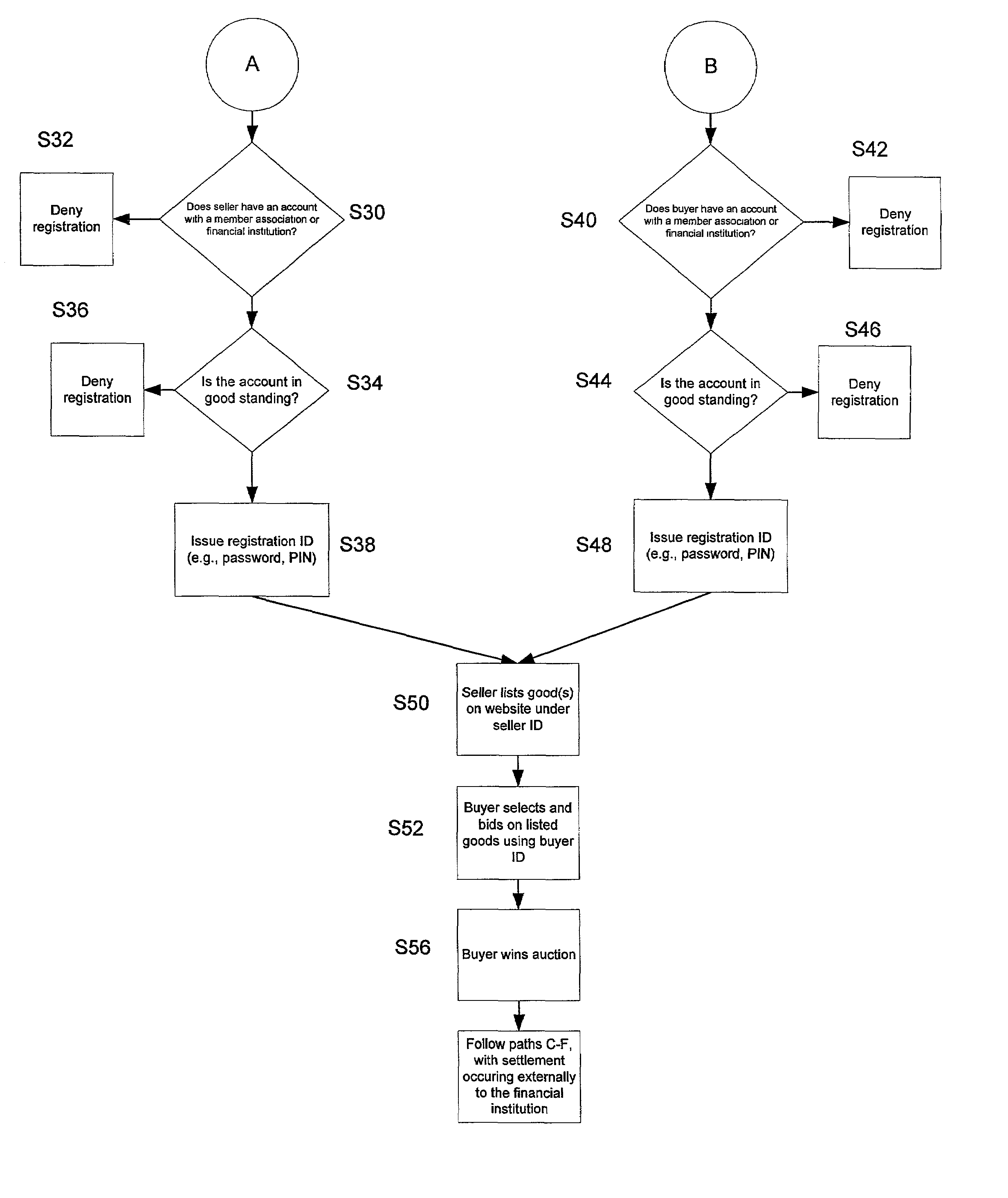

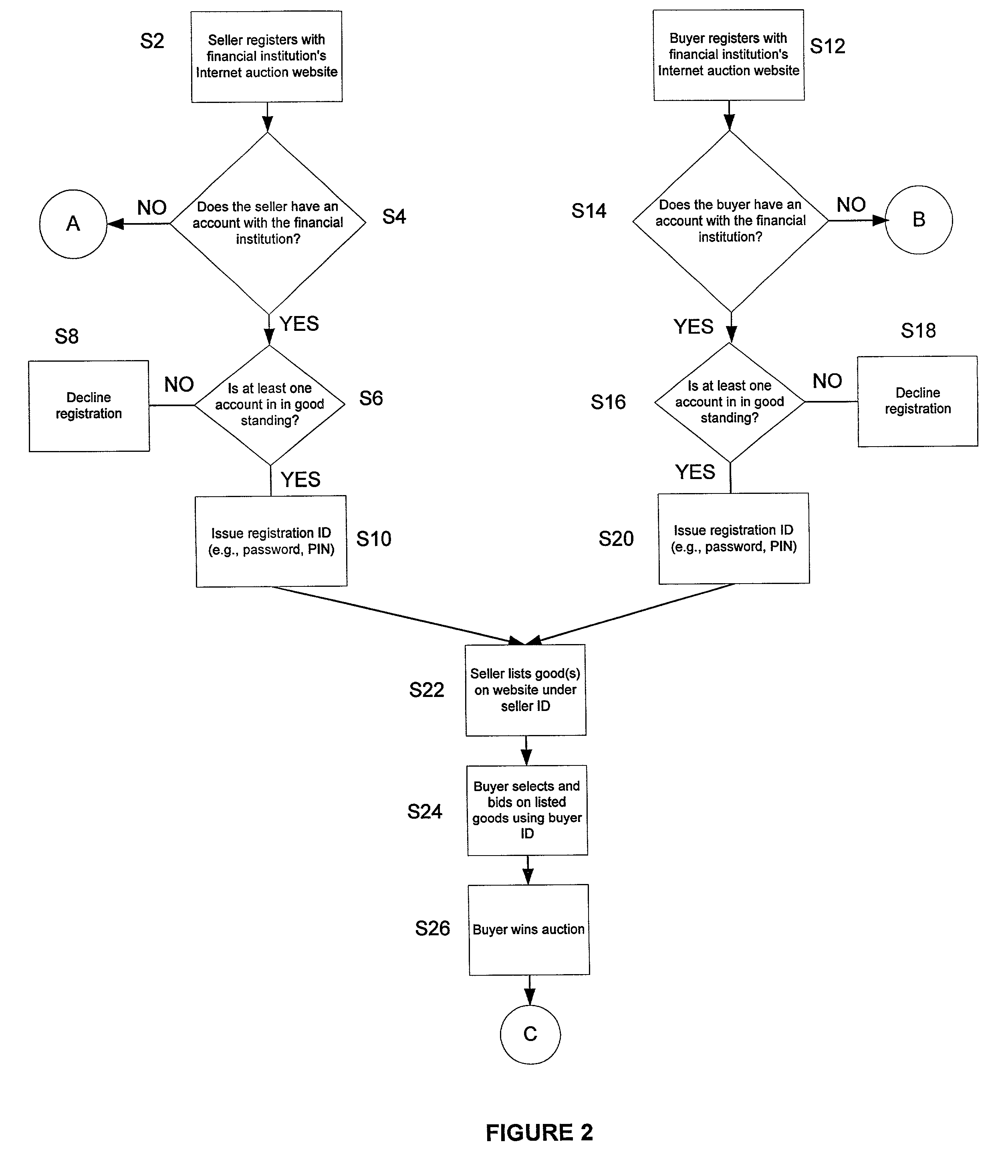

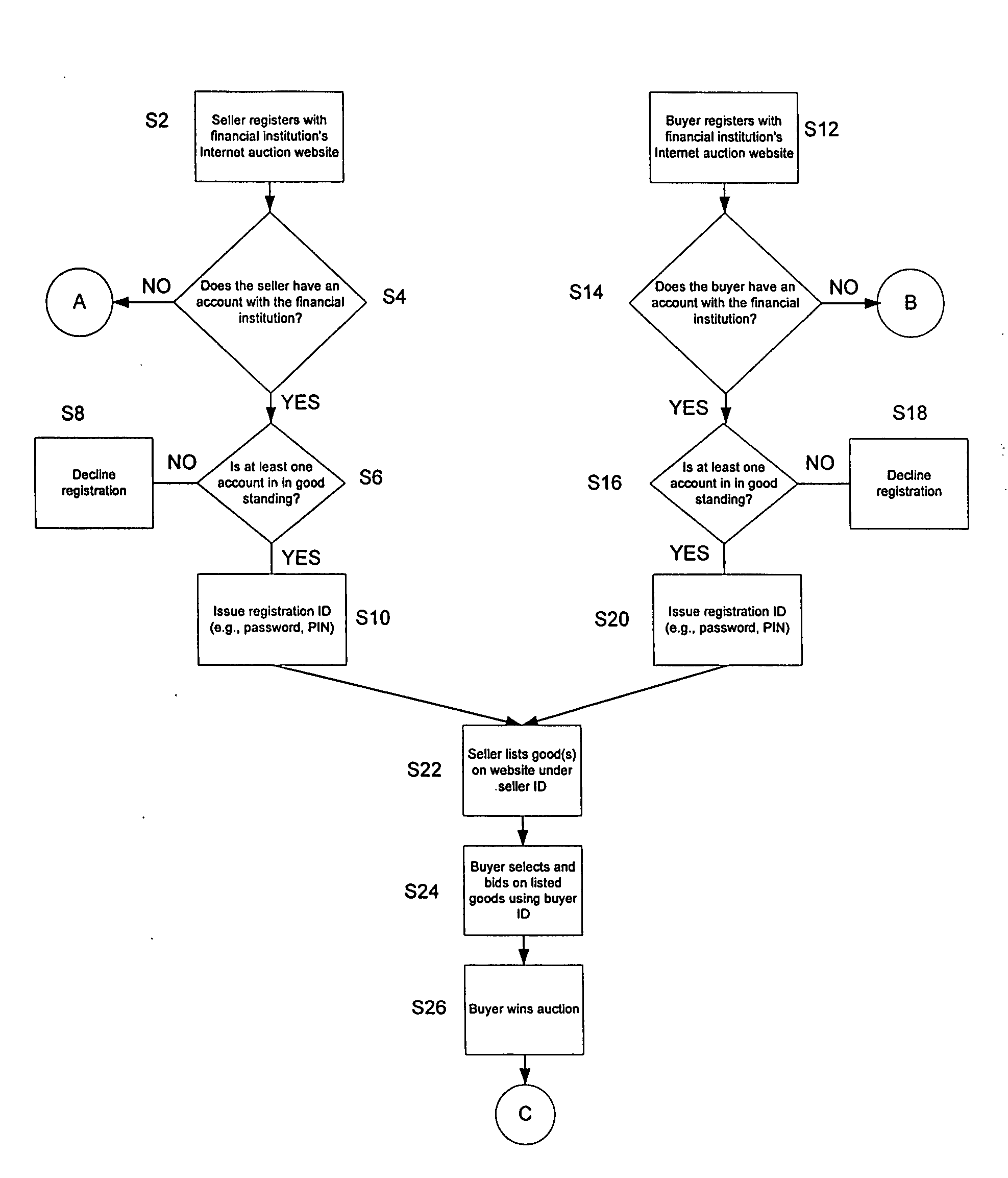

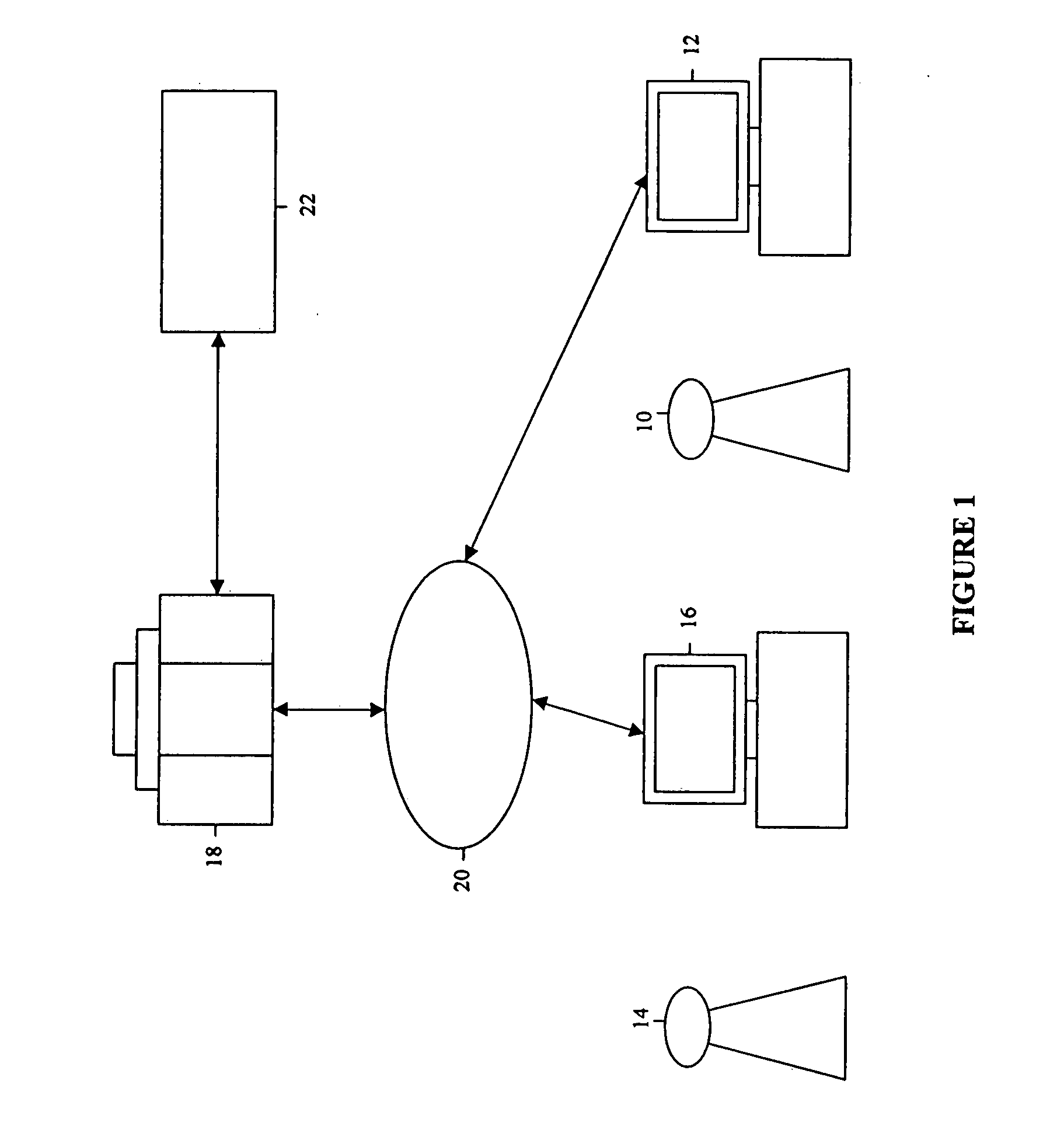

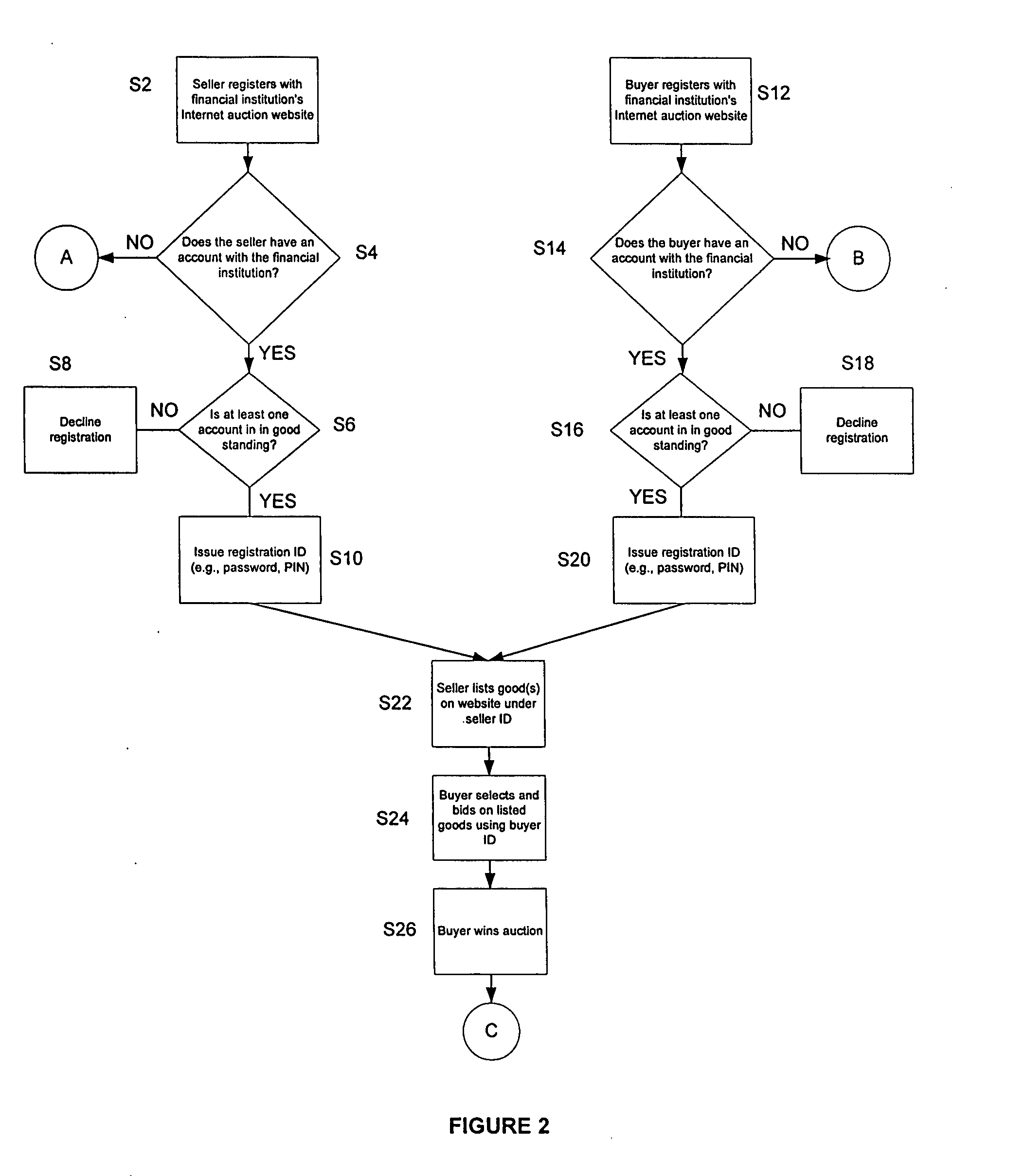

Method and system for managing and conducting a network auction

There is described a method and system for managing Internet auction transactions by creating an auction website by, for example, a financial institution. The auction website is accessible by the financial institution's account holders (e.g., holders of checking, savings, credit card, and investment accounts). Thus, all buyers and sellers in auction transactions on the auction site, for example, have accounts with the financial institution, with settlements occurring between the accounts of the users at the financial institution. Payments are debited from the buyer's account(s) with a credit going to the account of the seller, less any fees. All charges occur internally, so no interchange is owed, for example, to a card association in connection with a transaction. Financial institution customers benefit from the system in that buyers and sellers are authenticated and settlement occurs almost instantaneously.

Owner:CITICORP CREDIT SERVICES INC (USA)

Final sale merchandise card

InactiveUS7264153B1Acutation objectsHand manipulated computer devicesCommunications systemCard association

Owner:ROUNDMEUP

Process and system for providing automated responses for transaction operations

Various systems for managing chargeback, retrieval, and other requests from the card associations, issuing banks, merchant banks, or other financial institutions requiring a merchant's response are disclosed herein. Such systems may include various forms of hardware, software and manual processes intended to: (a) retrieve transaction requests; (b) retrieve merchant's transaction data; (c) gather merchant's data and compile with normalized transaction request data; (d) create response cases; (e) provide merchant notifications; and (f) transmit responses to requestors. With the present invention, these often independent and incompatible processes, including their non-standard data formats, are normalized and compiled into compatible formats that integrate and facilitate the automation of substantially all aspects of a given chargeback process in one embodiment.

Owner:SIGNATURELINK

Method and system for managing and conducting a network auction

InactiveUS20070255644A1Eliminate riskReduce riskFinancePayment architectureCredit cardInternet auctions

There is described a method and system for managing Internet auction transactions by creating an auction website by, for example, a financial institution. The auction website is accessible by the financial institution's account holders (e.g., holders of checking, savings, credit card, and investment accounts). Thus, all buyers and sellers in auction transactions on the auction site, for example, have accounts with the financial institution, with settlements occurring between the accounts of the users at the financial institution. Payments are debited from the buyer's account(s) with a credit going to the account of the seller, less any fees. All charges occur internally, so no interchange is owed, for example, to a card association in connection with a transaction. Financial institution customers benefit from the system in that buyers and sellers are authenticated and settlement occurs almost instantaneously.

Owner:ELDER RICHARD

Centralized electronic commerce card transactions

A central transaction server in electronic commerce card authorization system enables the electronic commerce card association to manage and monitor the authentication system. The central transaction server acts as an intermediary for all communications between the access control server used for authentication. If any portion of the authentication system fails, the central transaction server compensates by providing appropriate responses to other portions of the system. The centralized transaction server translates all incoming traffic into a format compatible with the intended recipient, enabling portions of the system to be upgraded without breaking compatibility with the non-upgraded portions. The centralized transaction server also enables the integration of formally separate portions of the authentication system into a single unit. The directory and the authentication history servers can be integrated into the central transaction server, and the central transaction server can initiate charges to the electronic commerce card automatically, bypassing the card acquirer.

Owner:VISA USA INC (US)

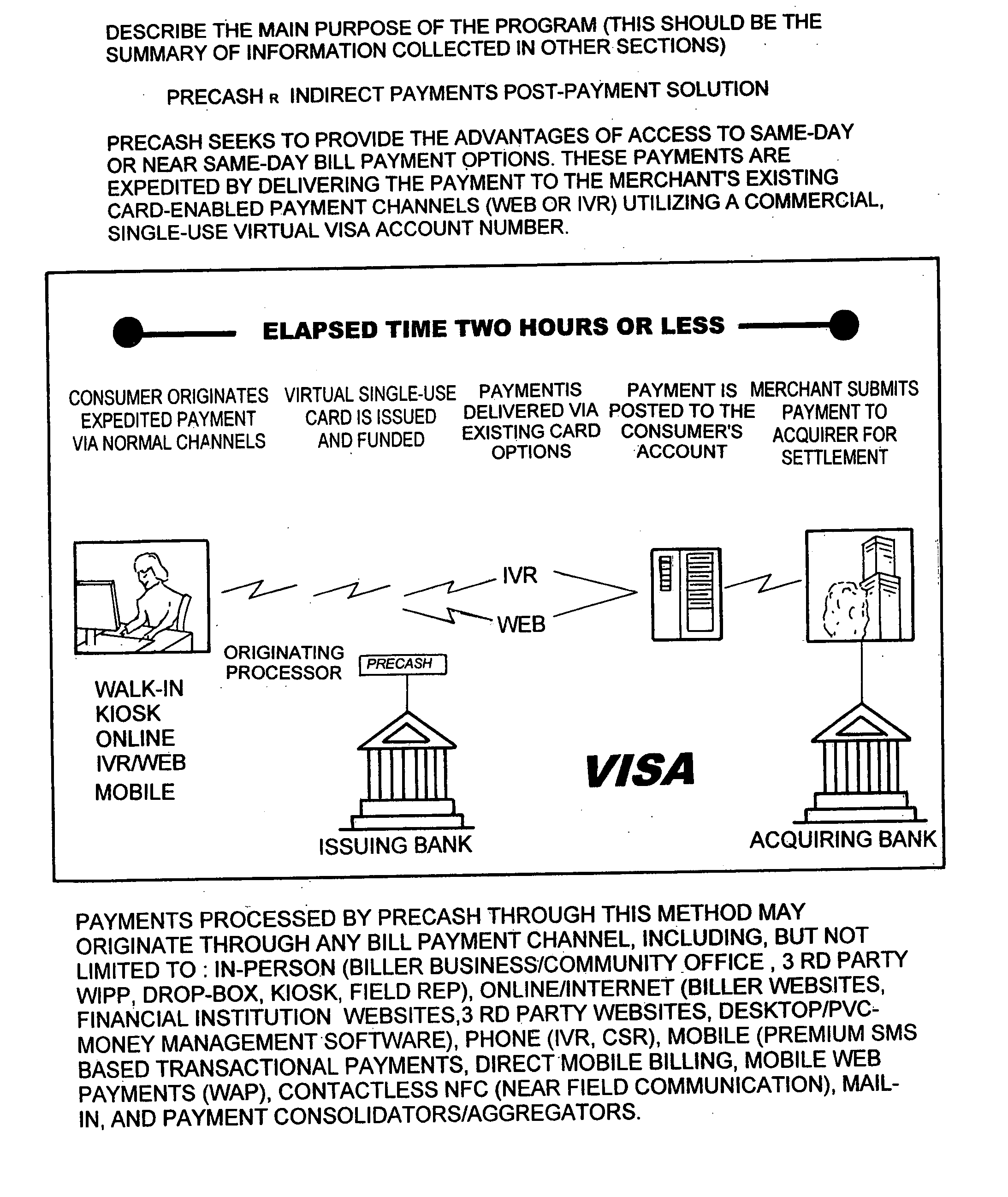

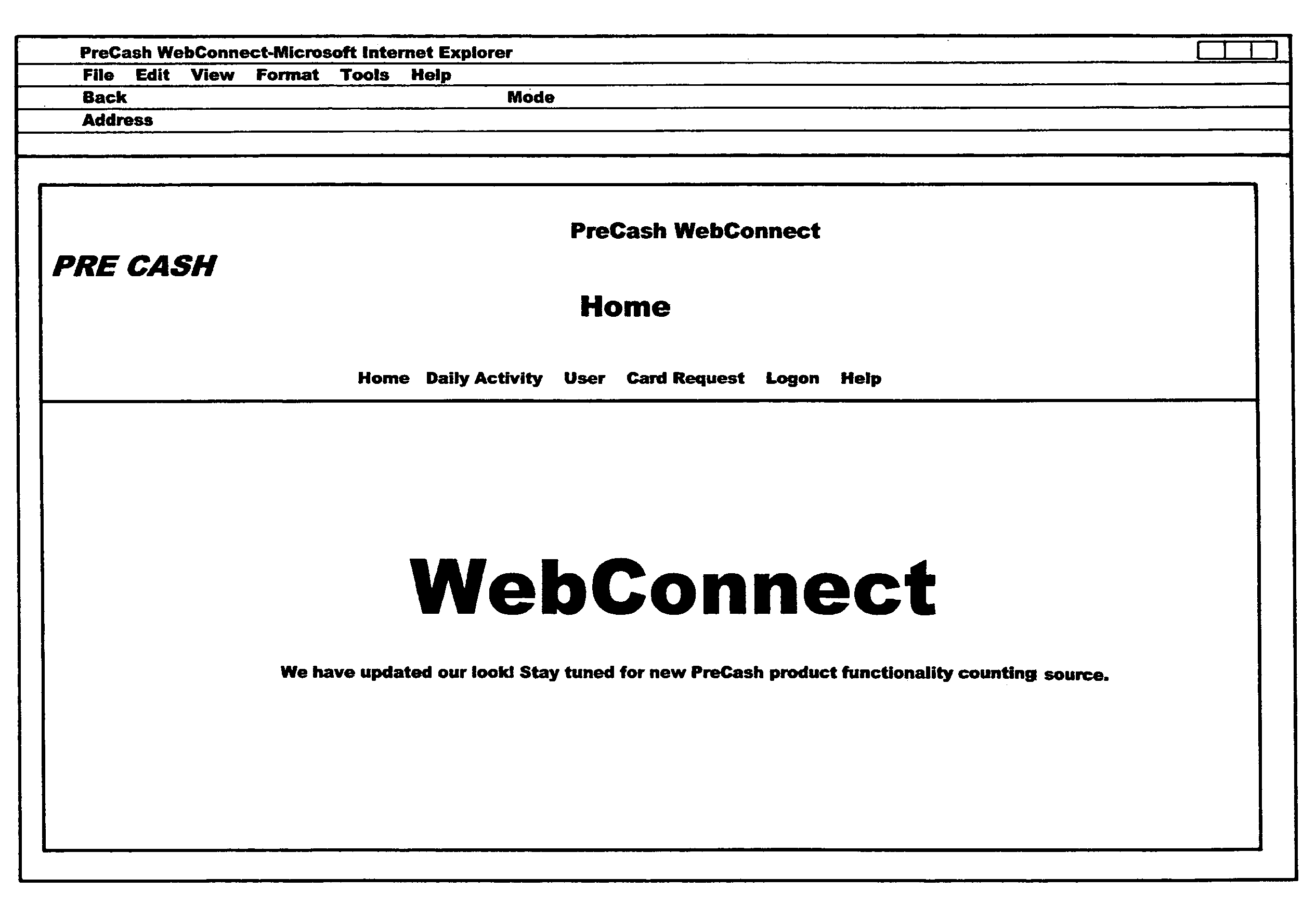

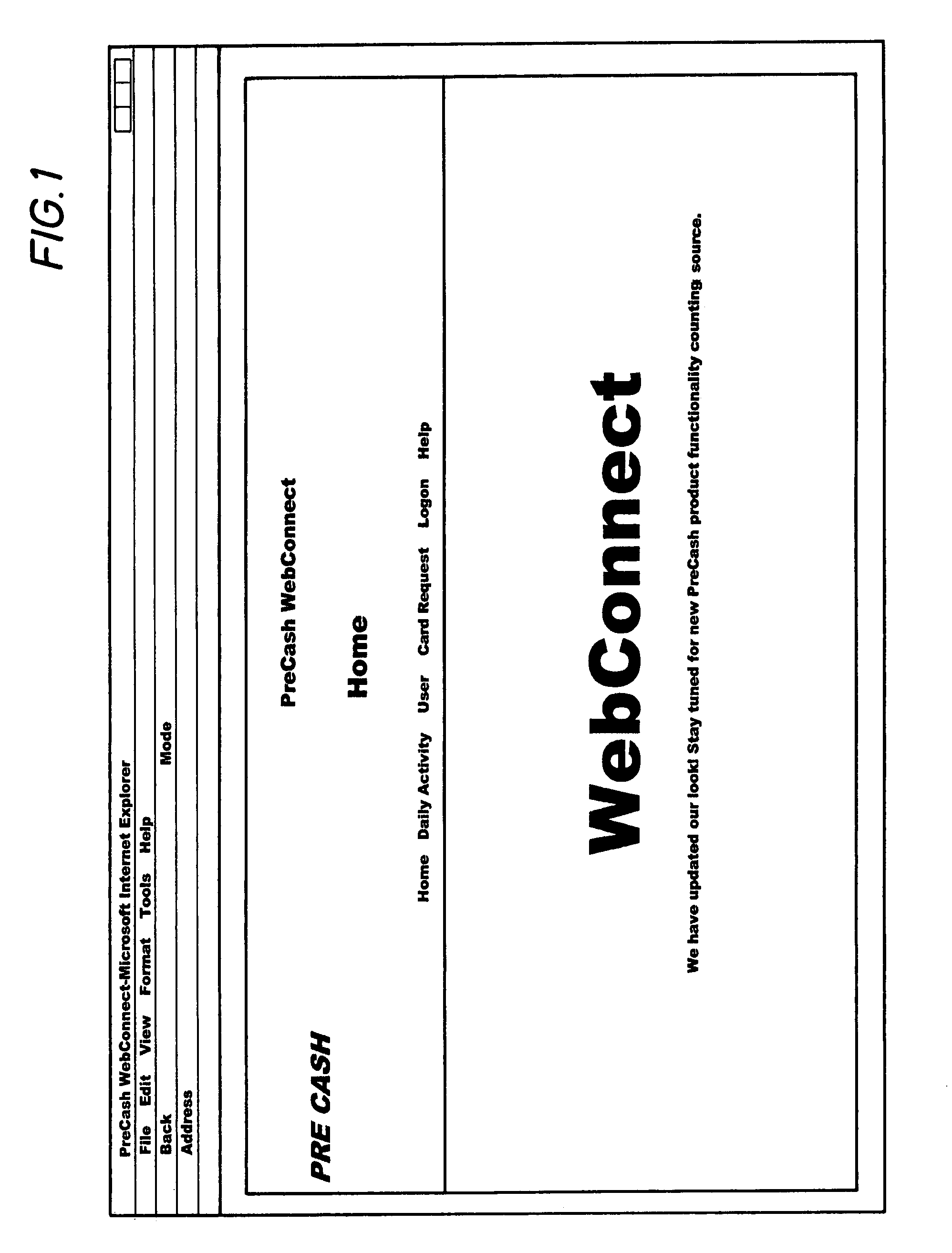

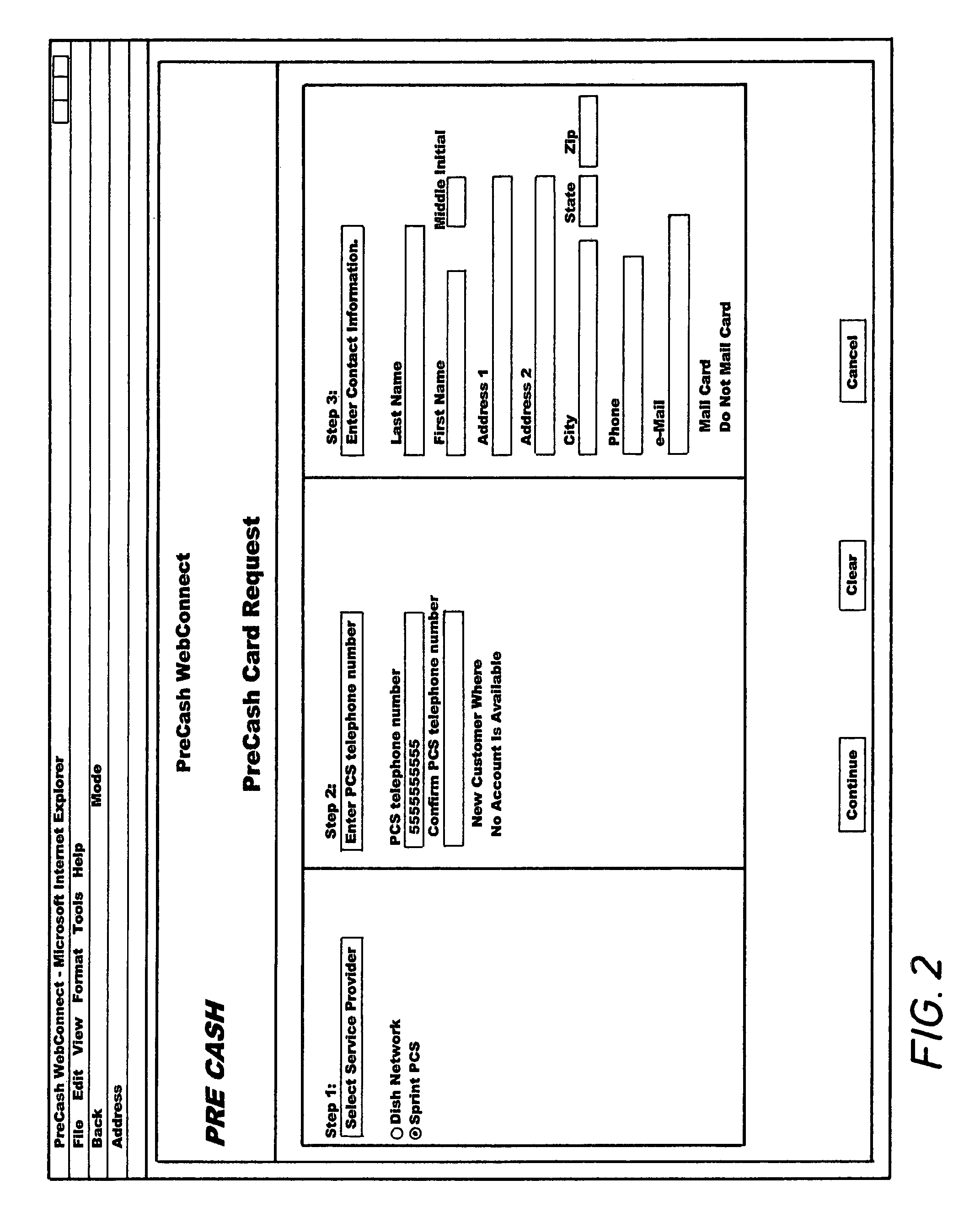

System and method for facilitating large scale payment transactions

InactiveUS20110313926A1Facilitating electronic payment(s)Convenient and efficient mannerFinanceMultiple digital computer combinationsPayment transactionInternet privacy

A system and method of payment of an end-user account with a service provider includes a computer system that makes payments to service providers on behalf of end-users and that is operable to exchange information with a terminal at the point of sale or a web-enabled computer system operated by the end-user and with the computer system of the service provider. In one embodiment, the computer system of an intermediary receives a request to make a payment on an end user's account with a service provider. The computer system of the intermediary may communicate with the computer system of the service provider by logging on to the web page of the service provider as the end-user, and entering a universally accepted open system number and the amount of the payment received from the end user's source of funds to effect payment on the end user's account with the service provider. In another preferred embodiment, a payment router together with an issuing / sponsoring bank and a processor, as implemented by their computer systems, facilitate payment transactions in which the router transacts at least thousands of payments for at least hundreds of payors with at least dozens of payees using at least one open system card association network, preferably in a day.

Owner:NOVENTIS

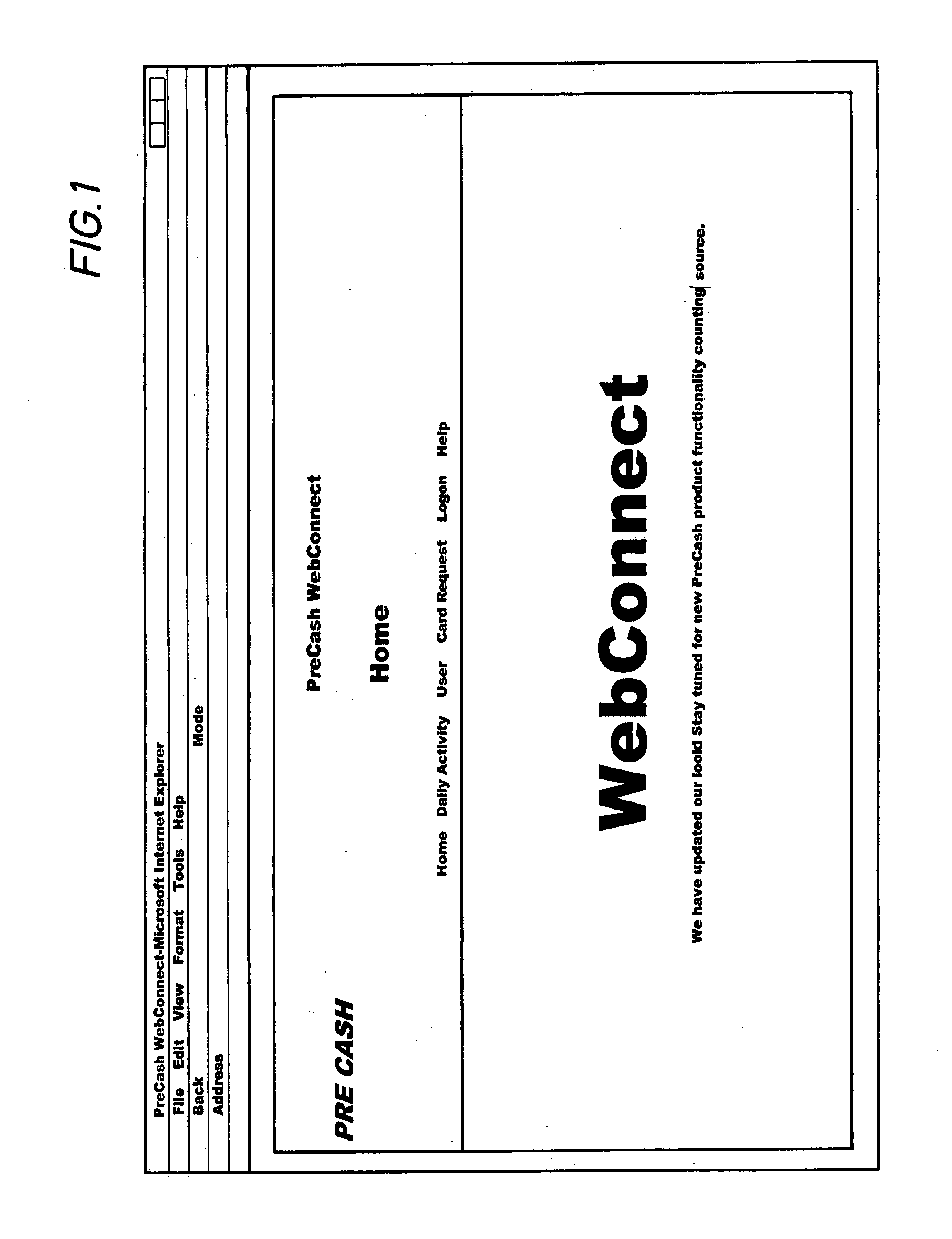

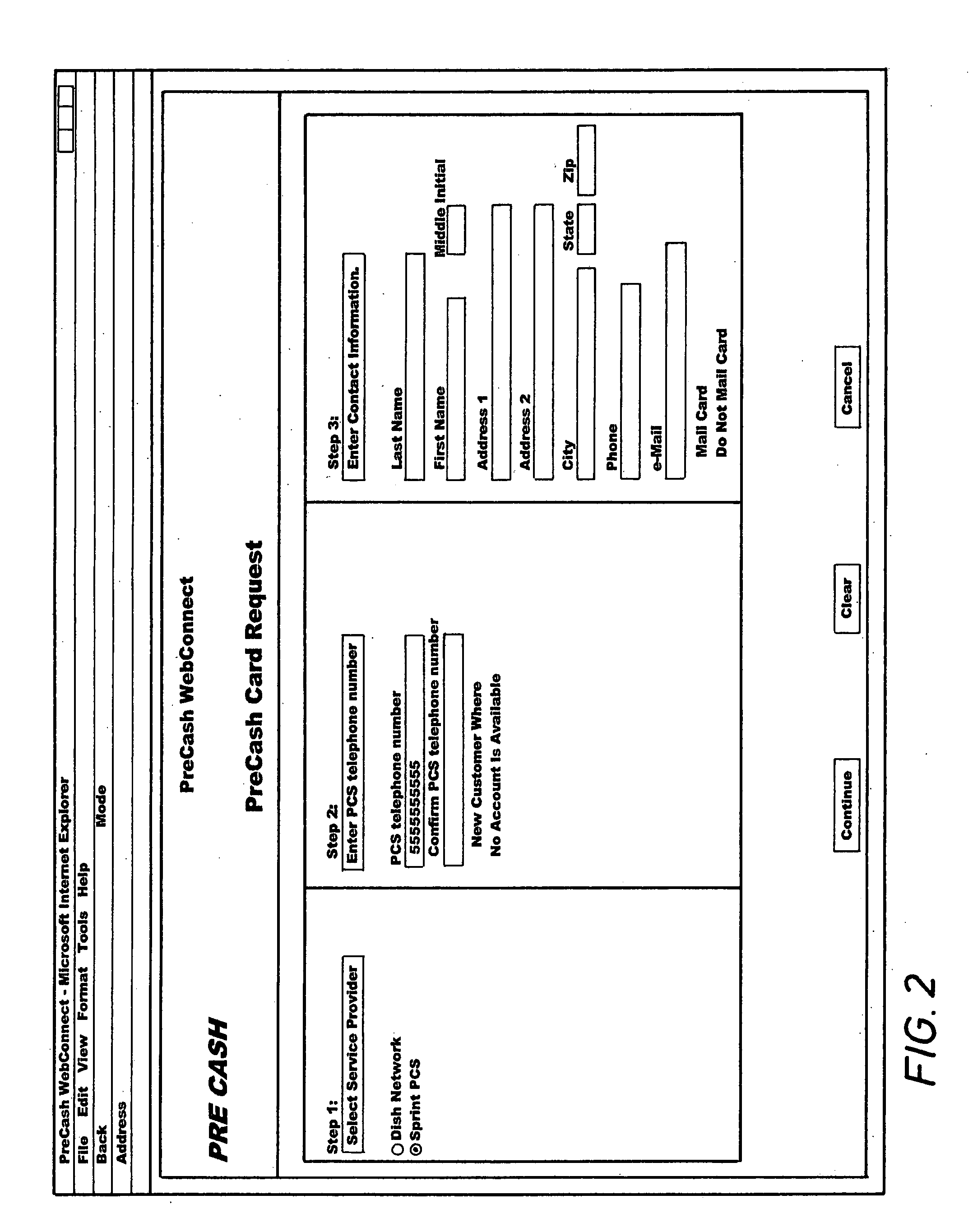

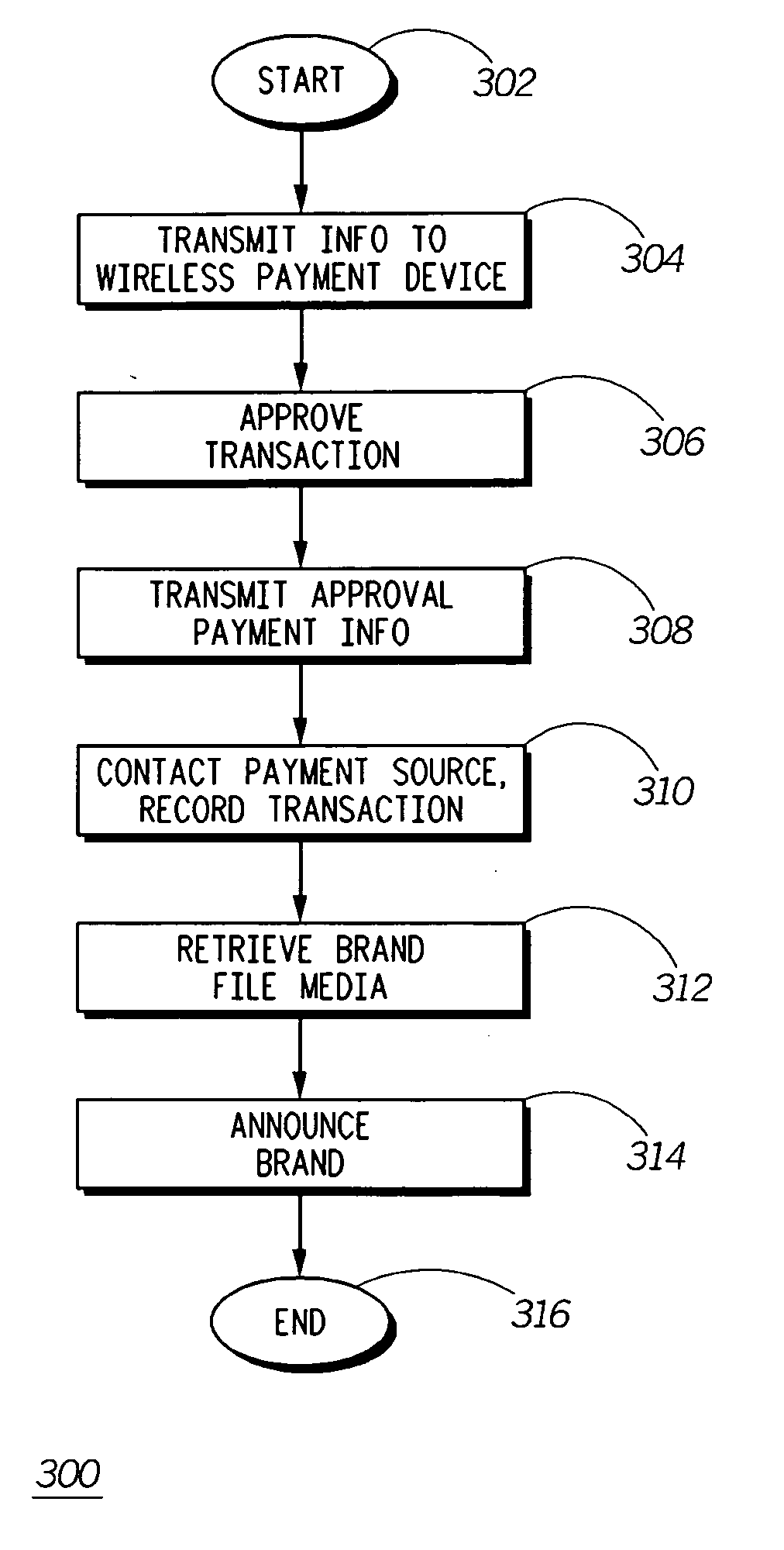

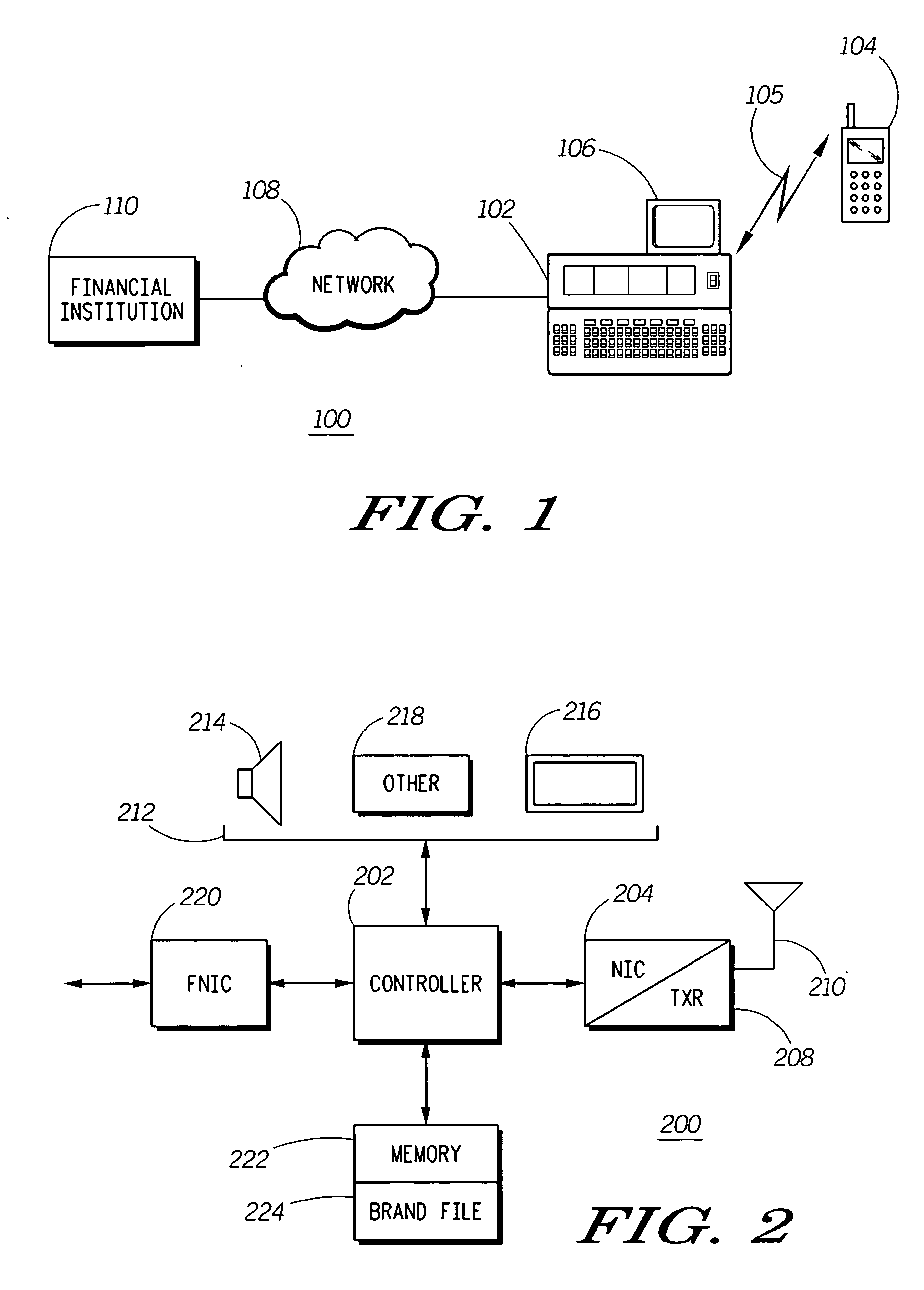

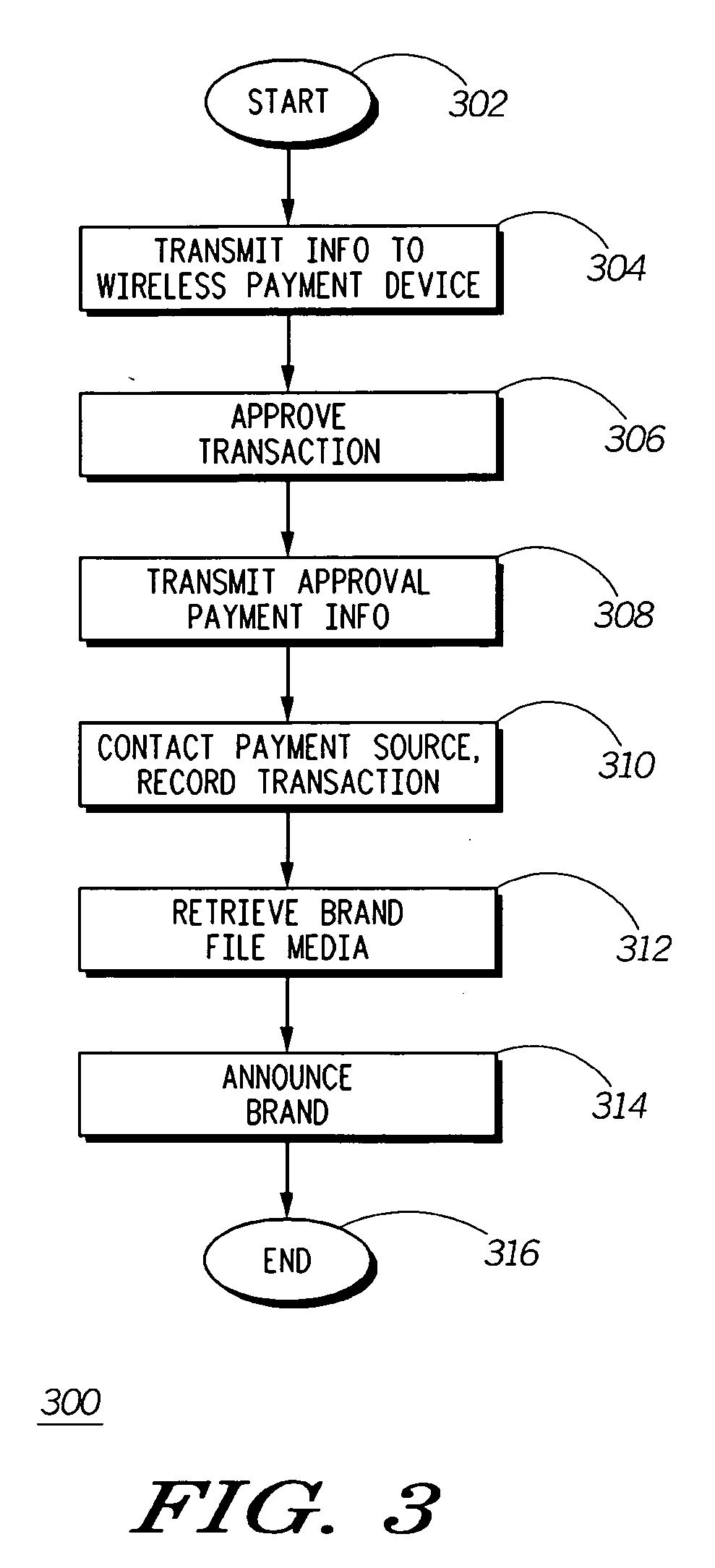

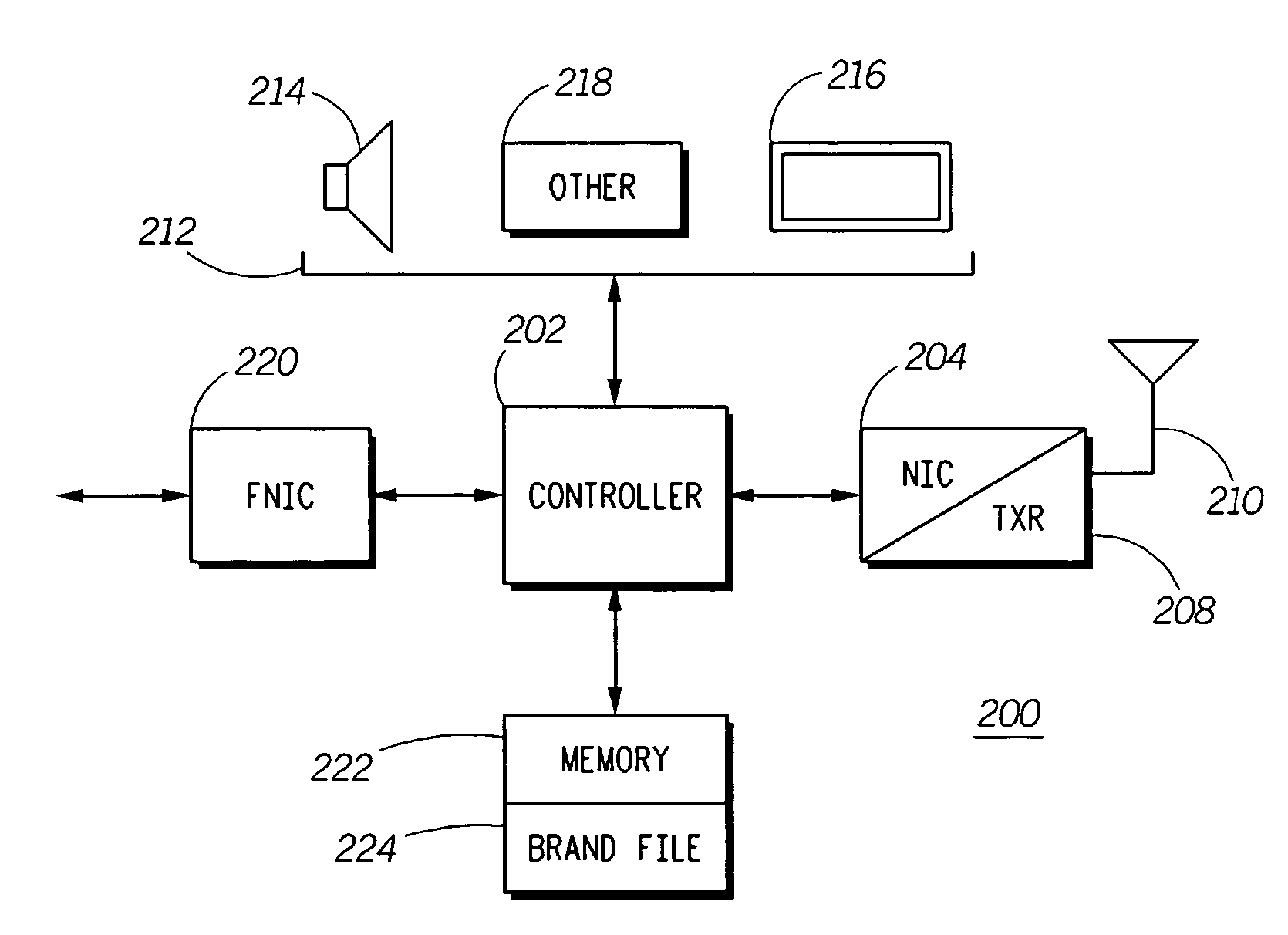

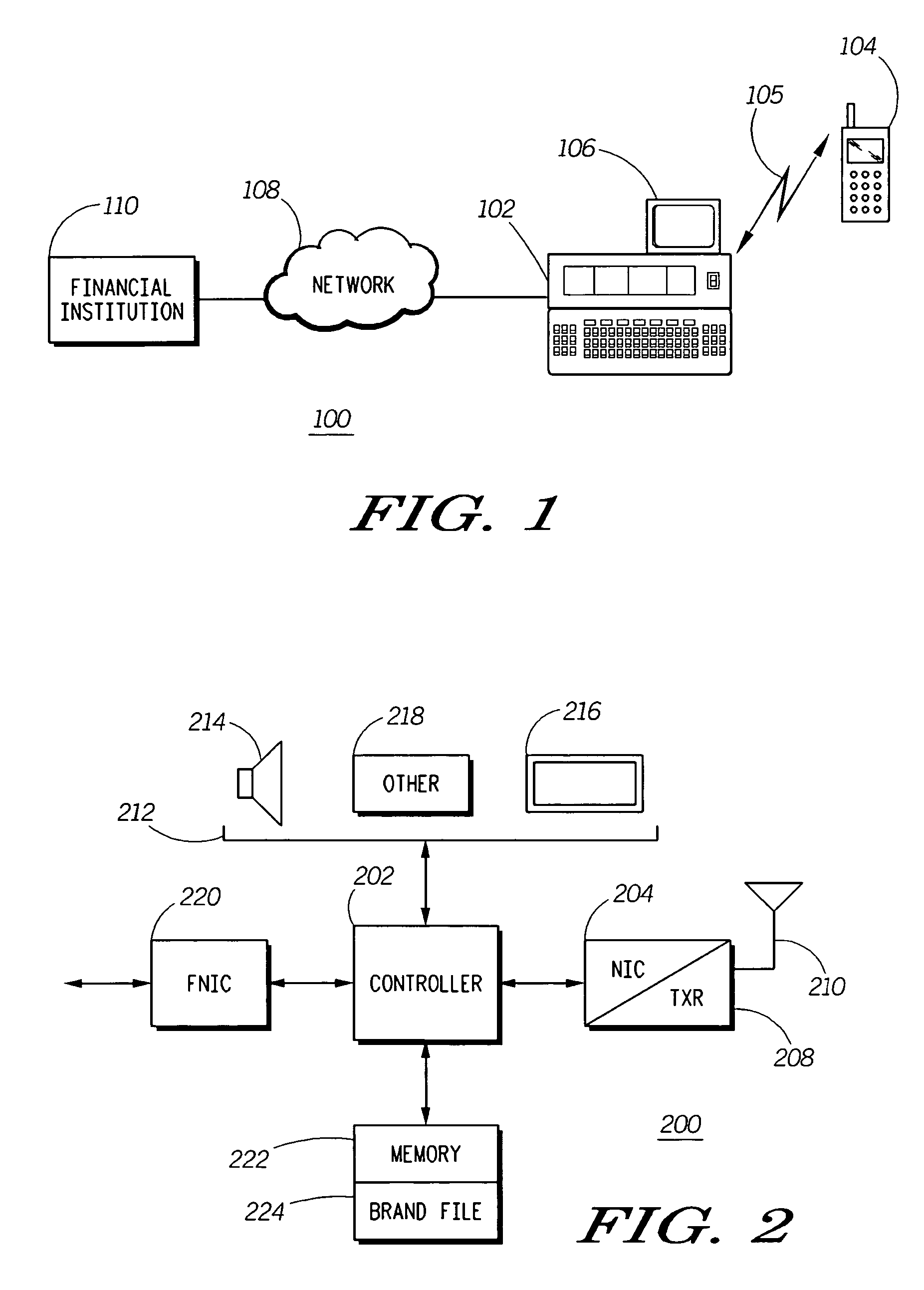

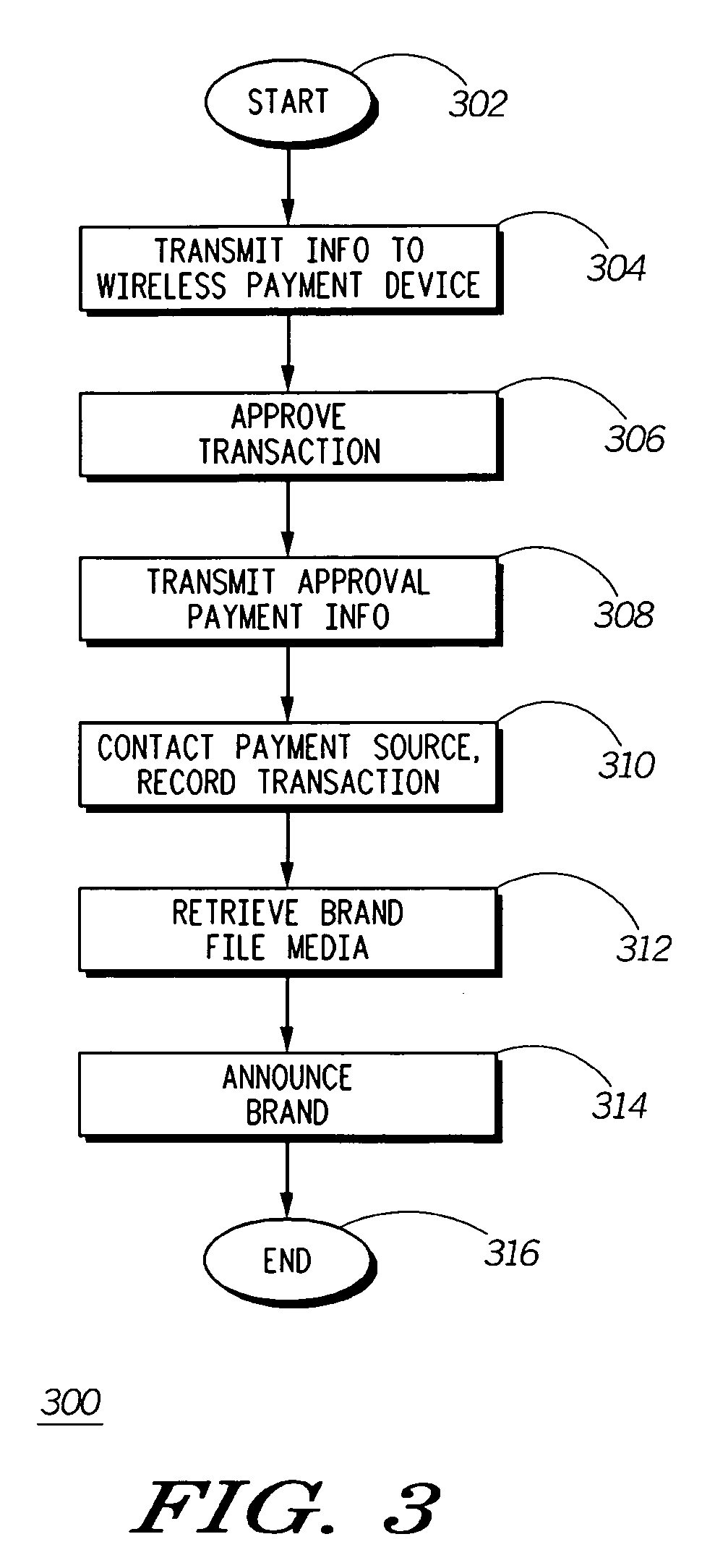

Payment brand announcement at a wireless payment point of sale device

A point of sale device (102) establishes a short range secure radio link (105) with a wireless payment device (104) to complete a transaction. The point of sale device transmits the transaction information to the wireless payment device (304) so the a user of the wireless payment device can approve the transaction (306). Upon approving the transaction, the wireless payment device transmits payment information to the point of sale device (308). The point of sale device uses the payment information to contact the appropriate payment source (110) to record the transaction. Upon the payment source confirming the transaction, the brand of the financial institution, card associations, and affinity groups acting as the payment source is announced so as to be observable by those in the vicinity of the point of sale device.

Owner:GOOGLE TECH HLDG LLC

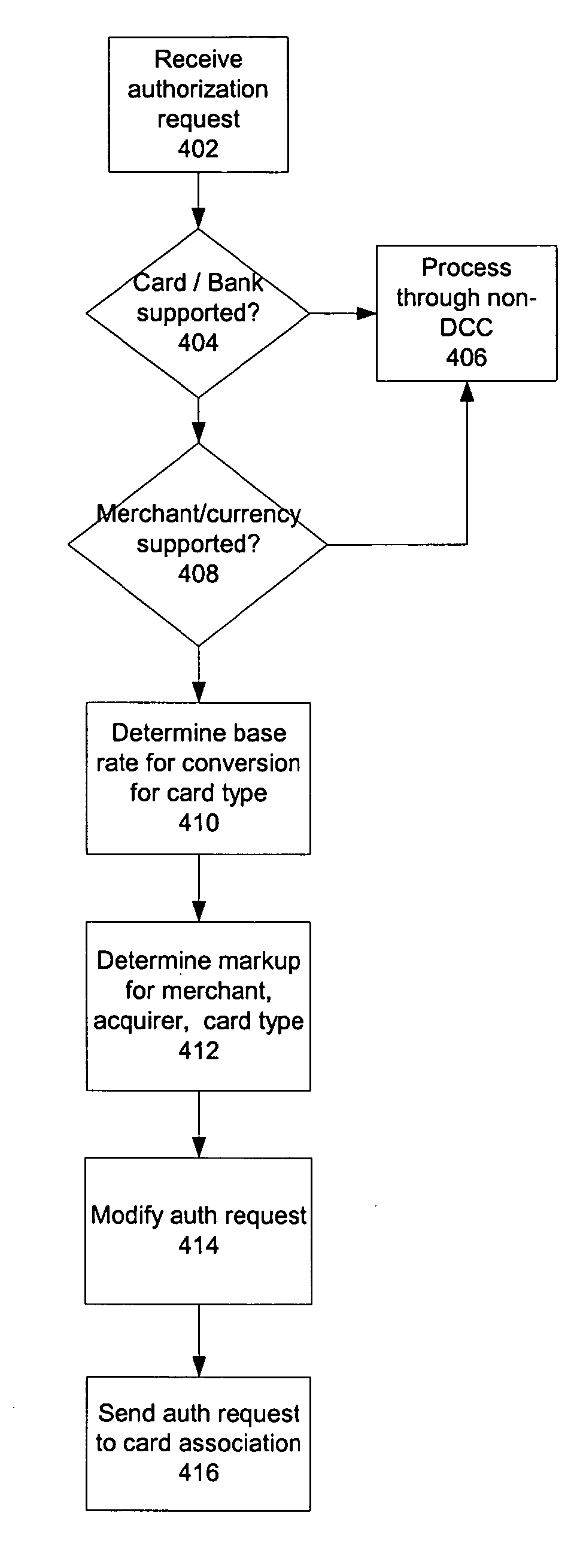

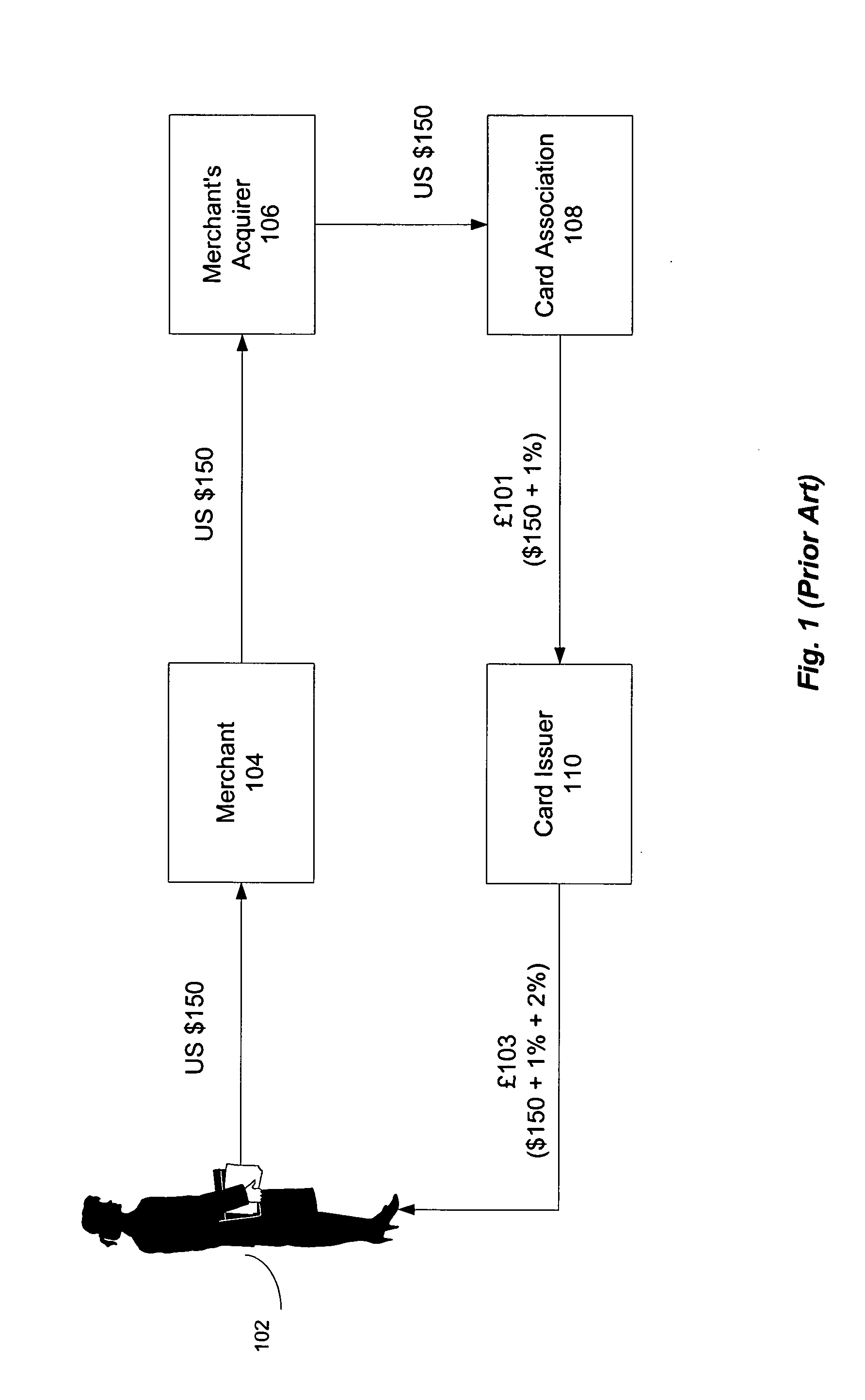

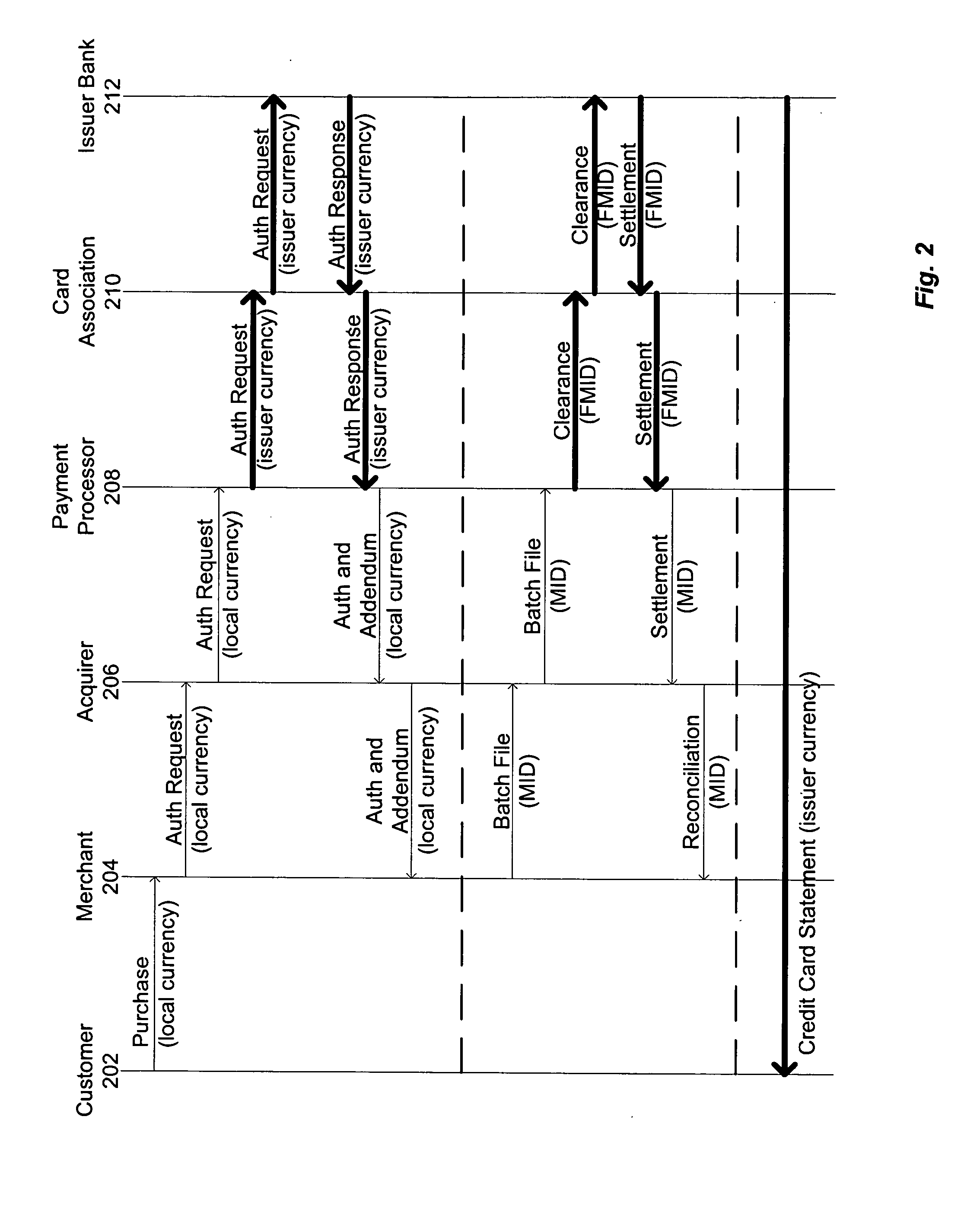

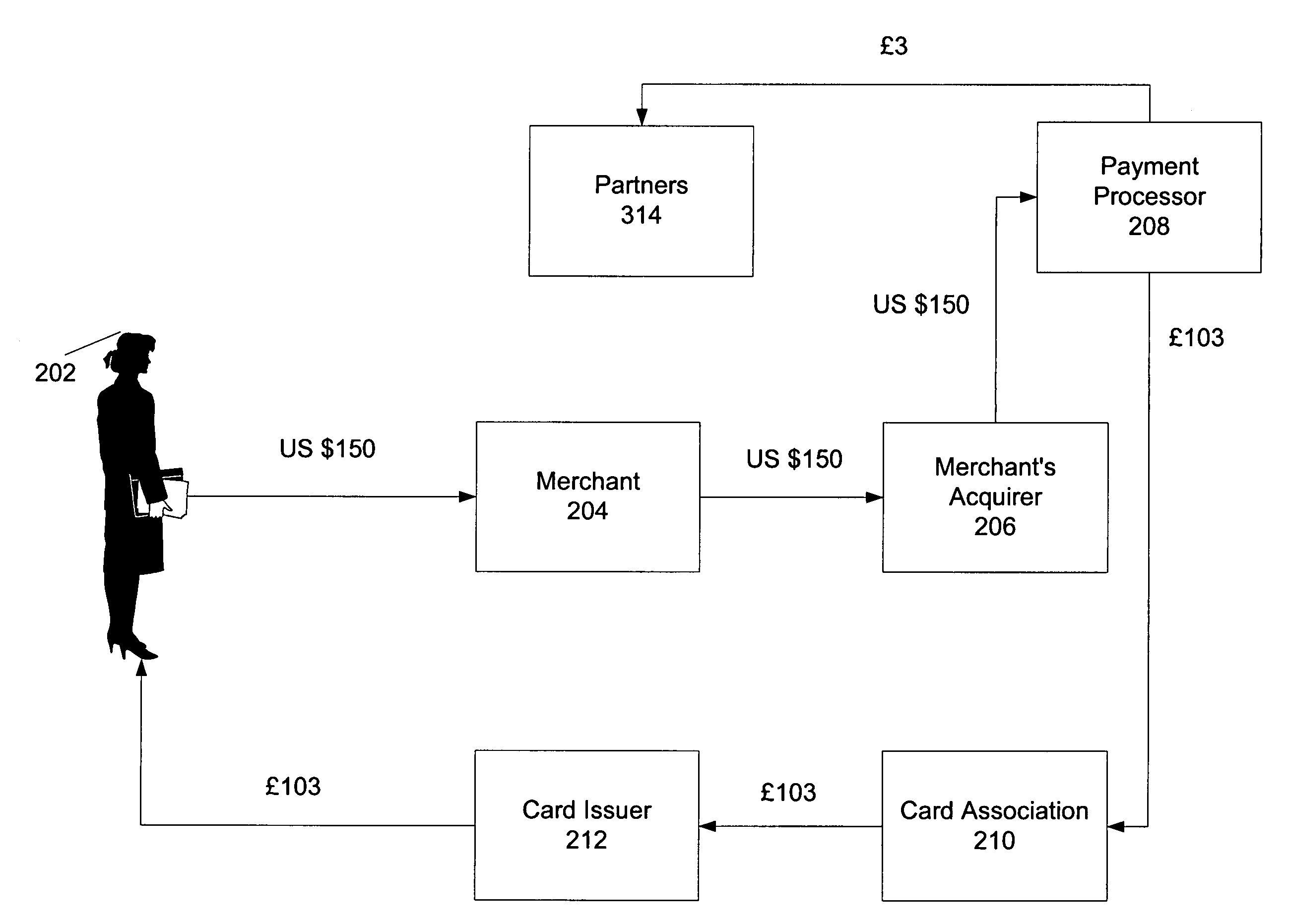

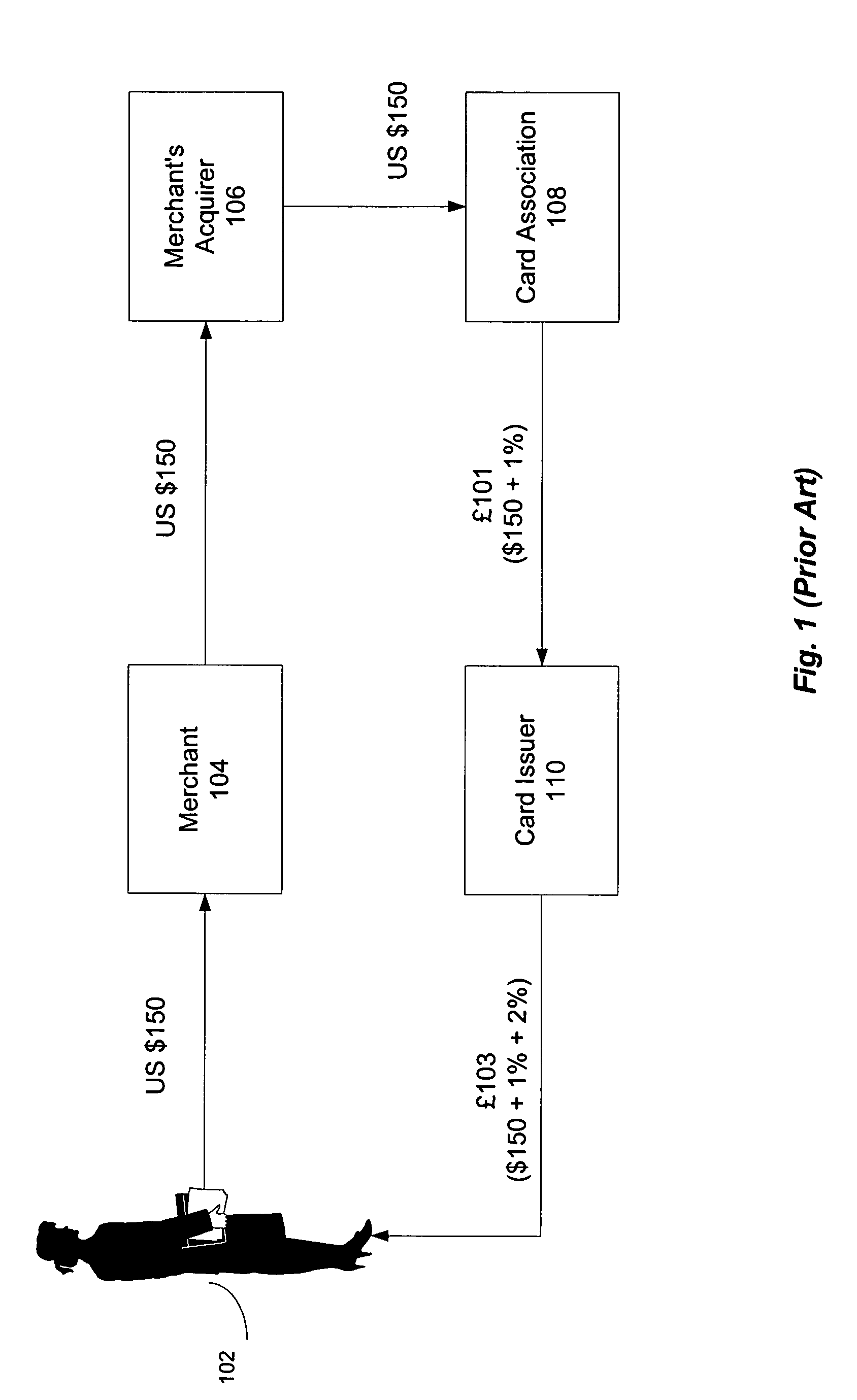

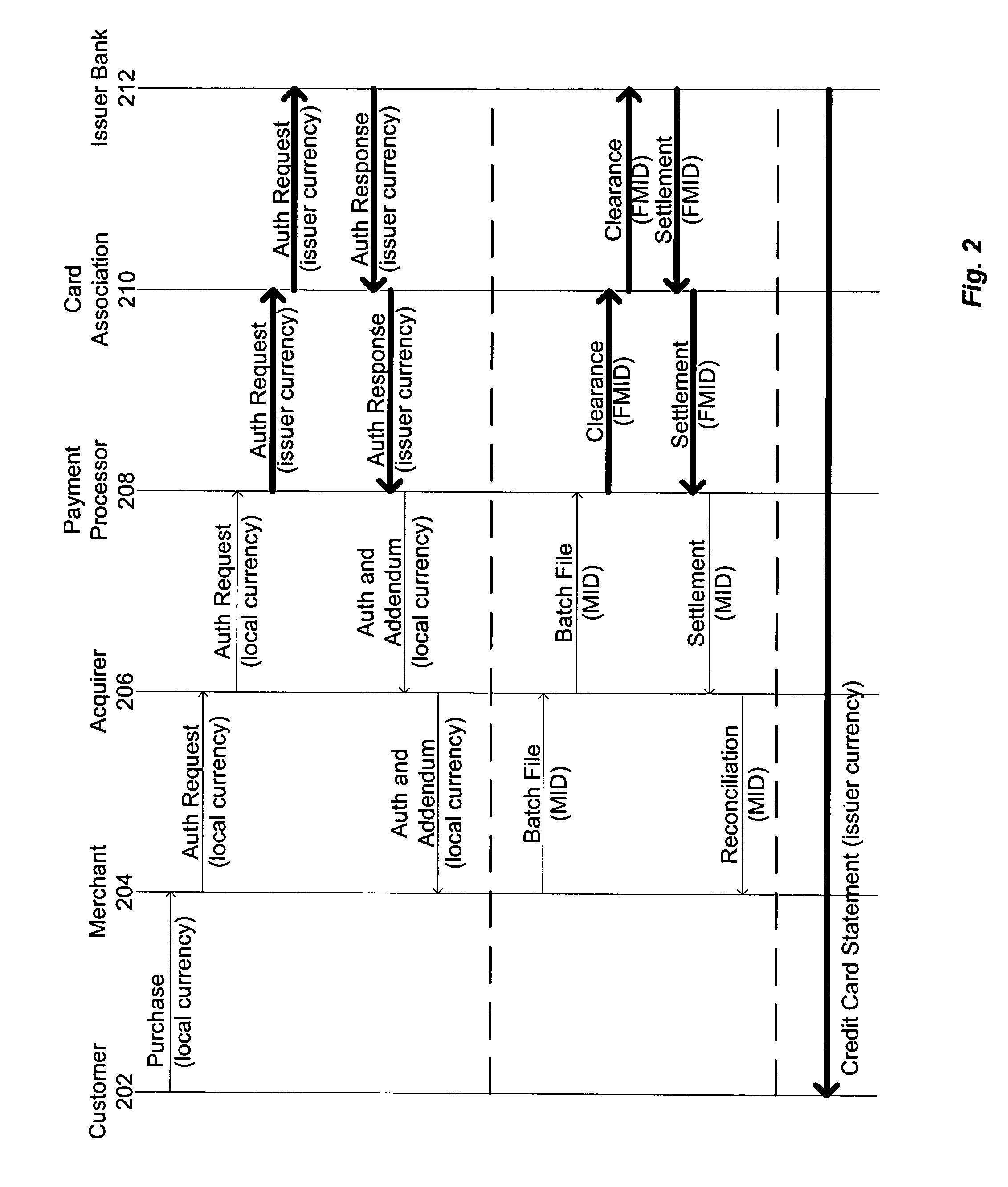

Time-of-transaction foreign currency conversion

Providing a time-of-transaction currency conversion from a merchant's local currency to a cardholder's credit card currency uses a conversion rate developed by reference to the particular merchant, acquirer, card association and issuer. After a merchant has generated an authorization request in the merchant's currency for a transaction by a cardholder in a different currency, the transaction amount in the authorization is converted from the merchant's currency to the currency of the cardholder's issuing currency, and optionally modified to include additional fees. The converted authorization request is then transmitted to the appropriate card association and then to the issuing bank for authorization, with a response returned to the merchant. The cardholder sees and approves the transaction in the cardholder's currency, and in an amount identical to the amount for which he will be billed.

Owner:PLANET PAYMENT

Payment brand announcement at a wireless payment point of sale device

A point of sale device (102) establishes a short range secure radio link (105) with a wireless payment device (104) to complete a transaction. The point of sale device transmits the transaction information to the wireless payment device (304) so the a user of the wireless payment device can approve the transaction (306). Upon approving the transaction, the wireless payment device transmits payment information to the point of sale device (308). The point of sale device uses the payment information to contact the appropriate payment source (110) to record the transaction. Upon the payment source confirming the transaction, the brand of the financial institution, card associations, and affinity groups acting as the payment source is announced so as to be observable by those in the vicinity of the point of sale device.

Owner:GOOGLE TECHNOLOGY HOLDINGS LLC

Process and system for providing automated responses for transaction operations

Various systems for managing chargeback, retrieval, and other requests from the card associations, issuing banks, merchant banks, or other financial institutions requiring a merchant's response are disclosed herein. Such systems may include various forms of hardware, software and manual processes intended to: (a) retrieve transaction requests; (b) retrieve merchant's transaction data; (c) gather merchant's data and compile with normalized transaction request data; (d) create response cases; (e) provide merchant notifications; and (f) transmit responses to requestors. With the present invention, these often independent and incompatible processes, including their non-standard data formats, are normalized and compiled into compatible formats that integrate and facilitate the automation of substantially all aspects of a given chargeback process in one embodiment.

Owner:SIGNATURELINK

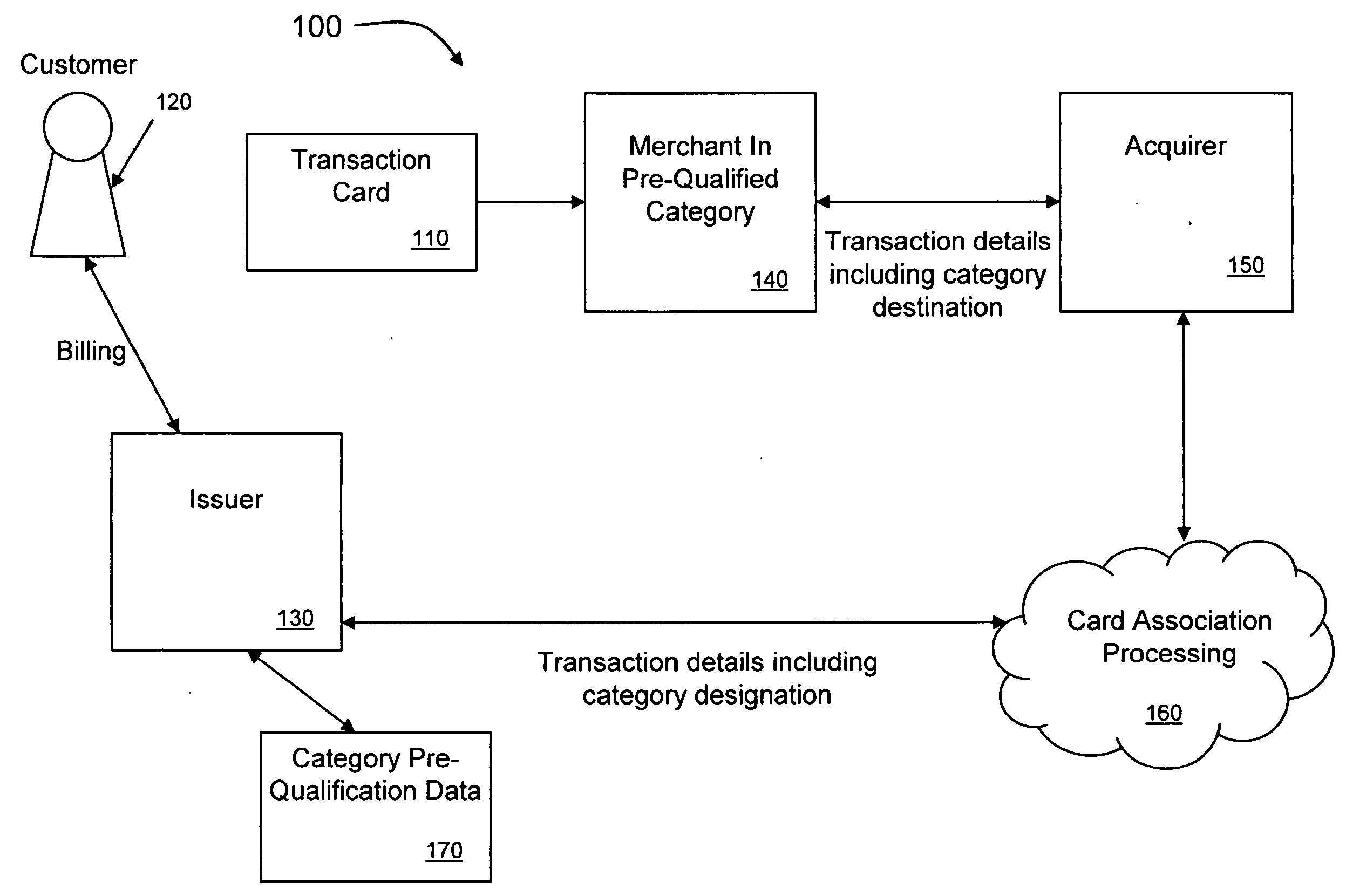

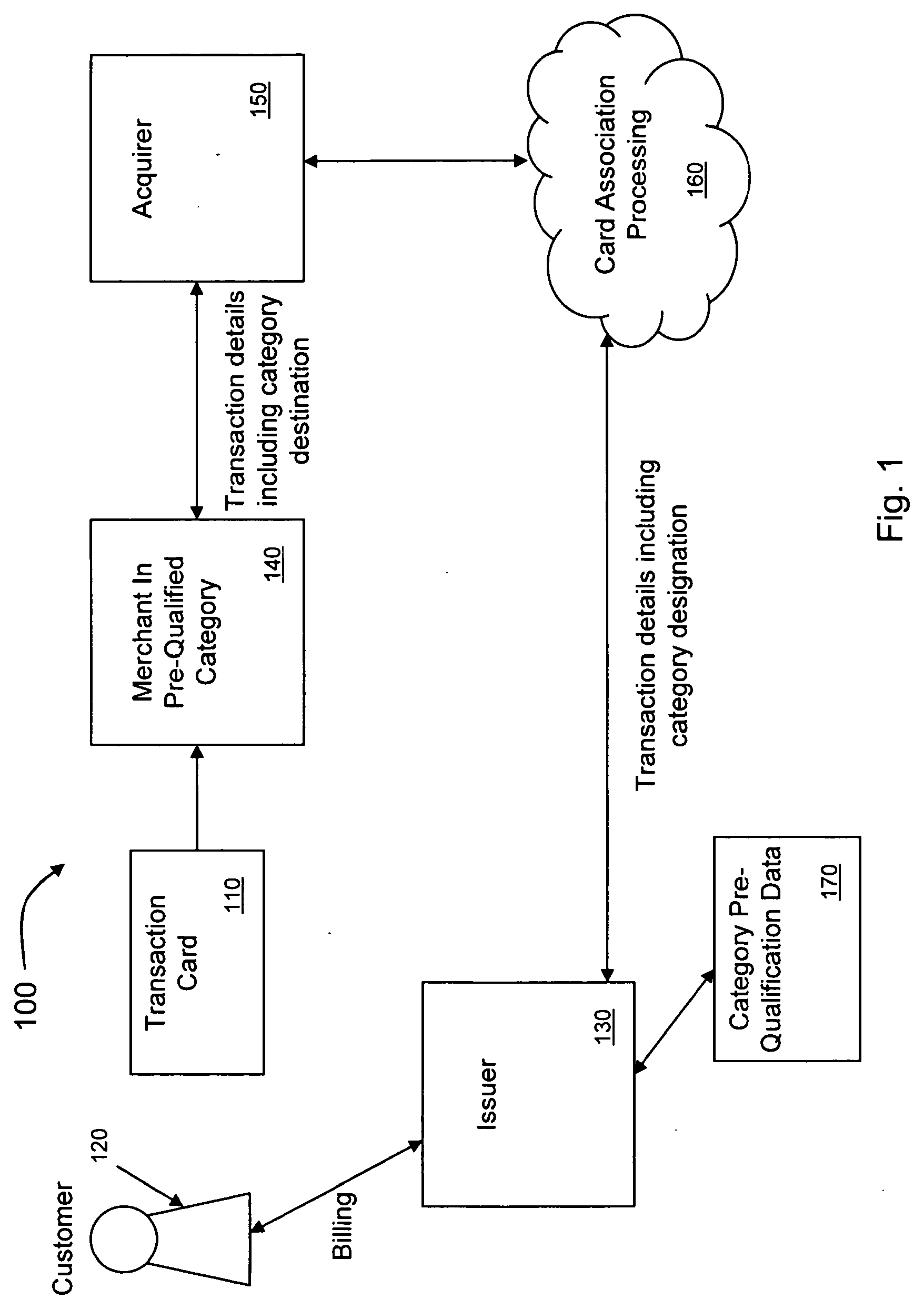

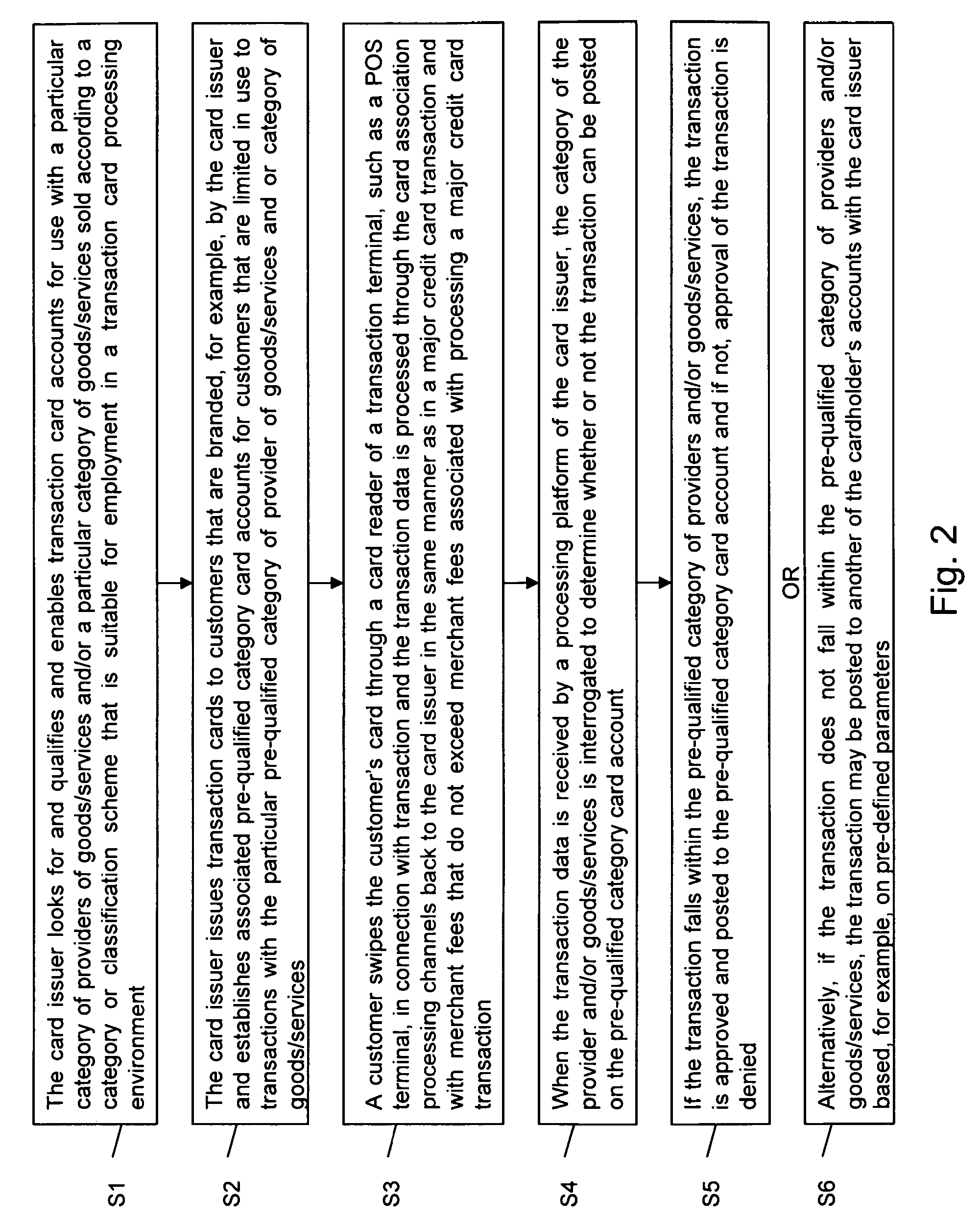

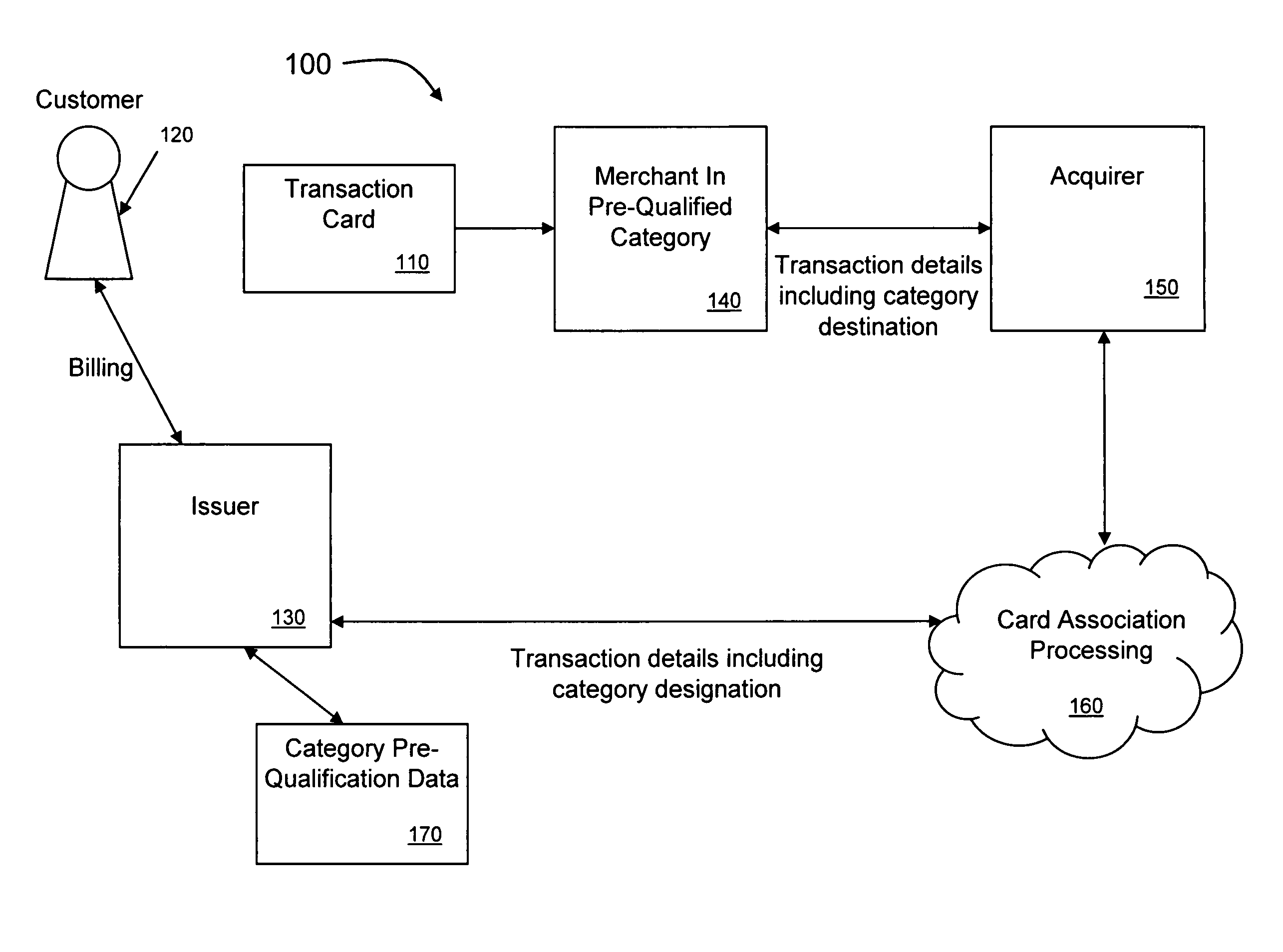

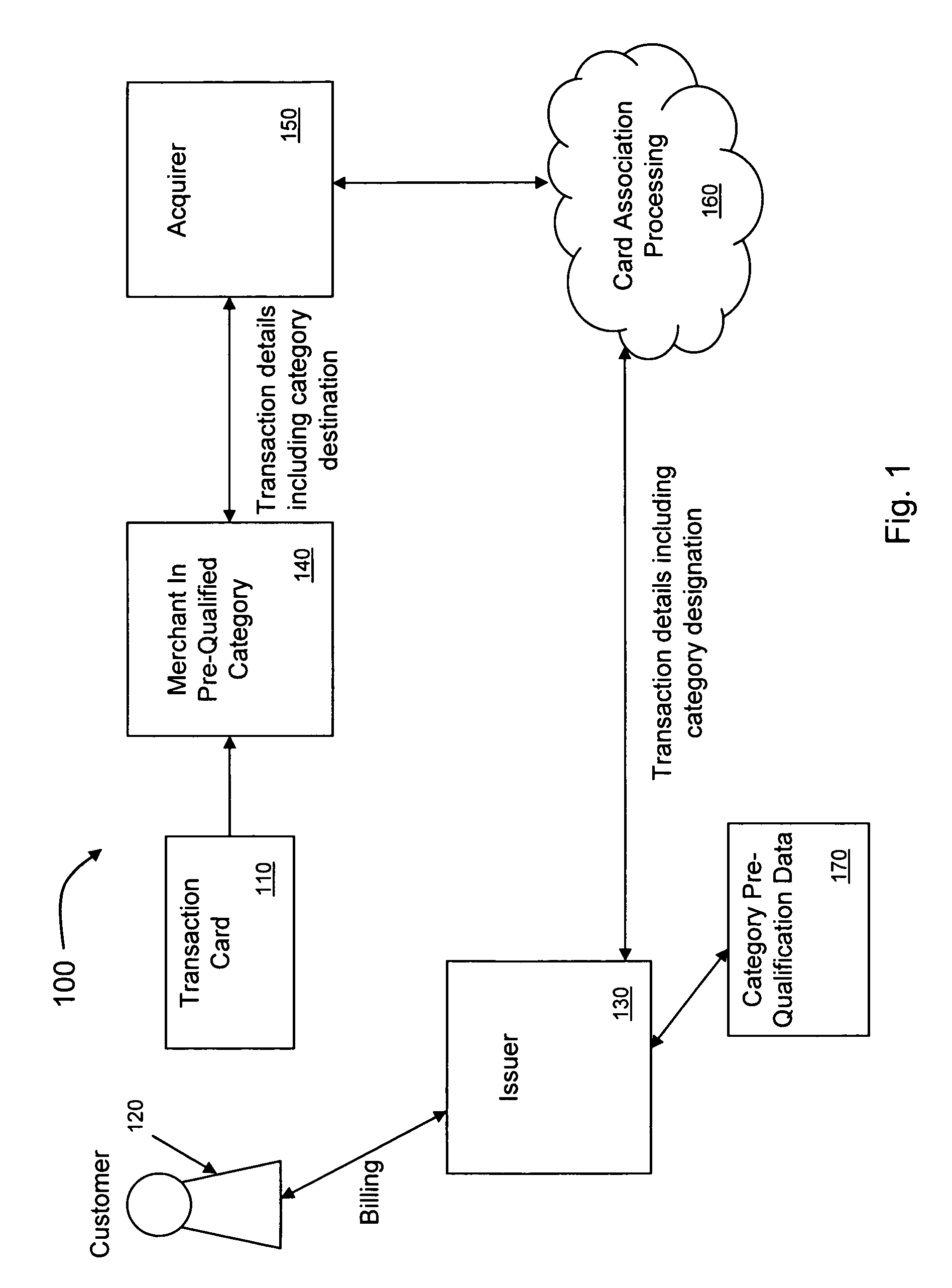

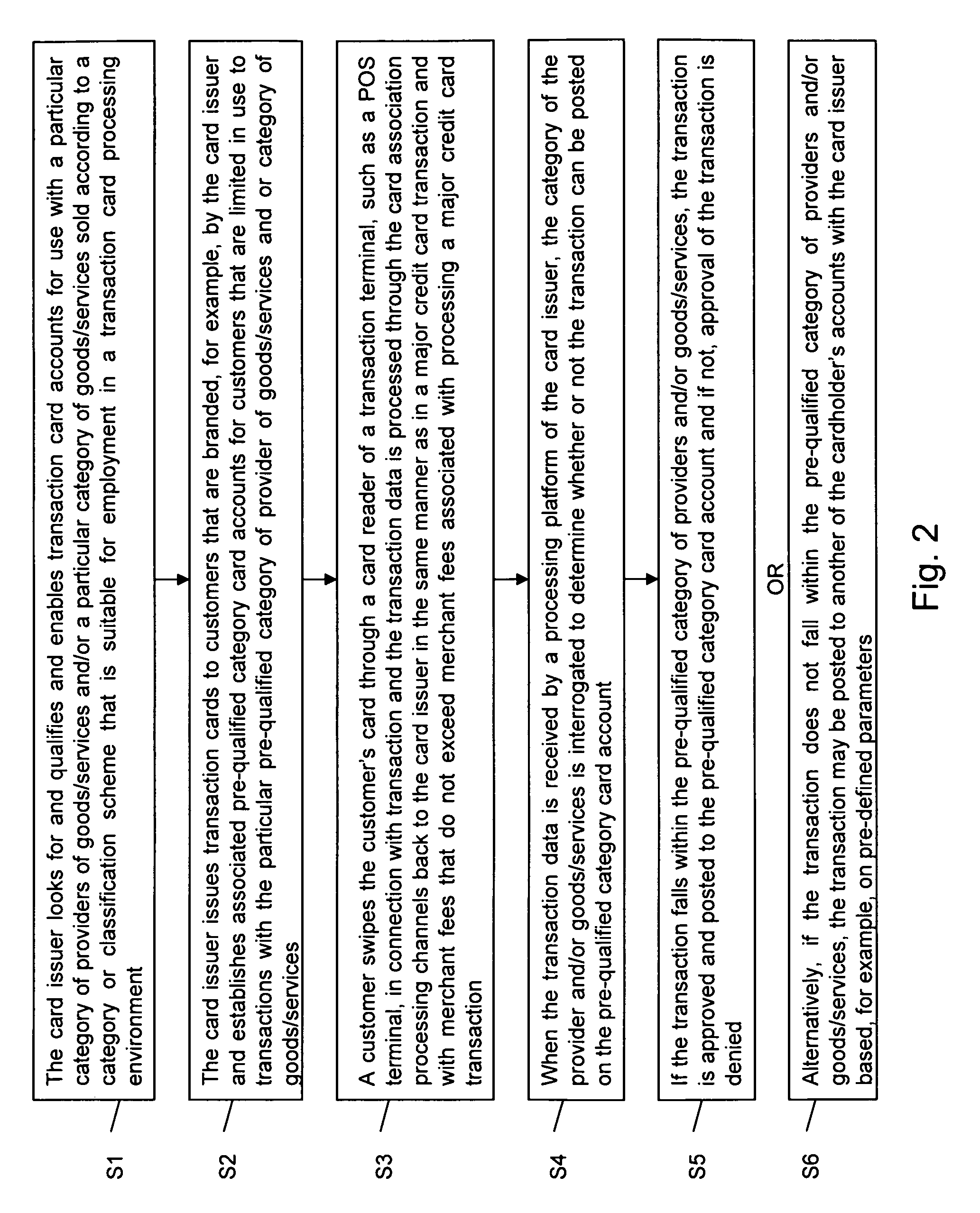

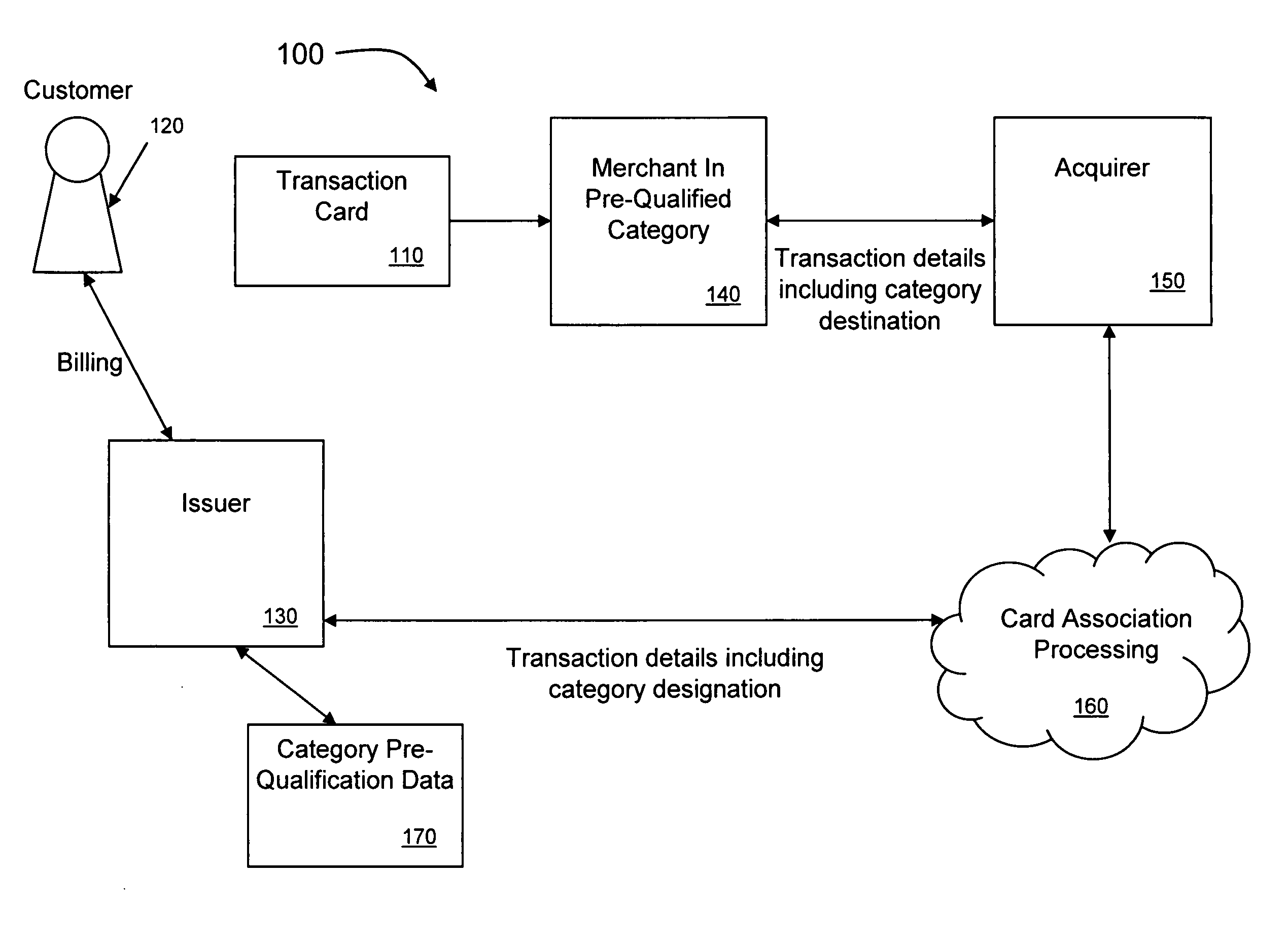

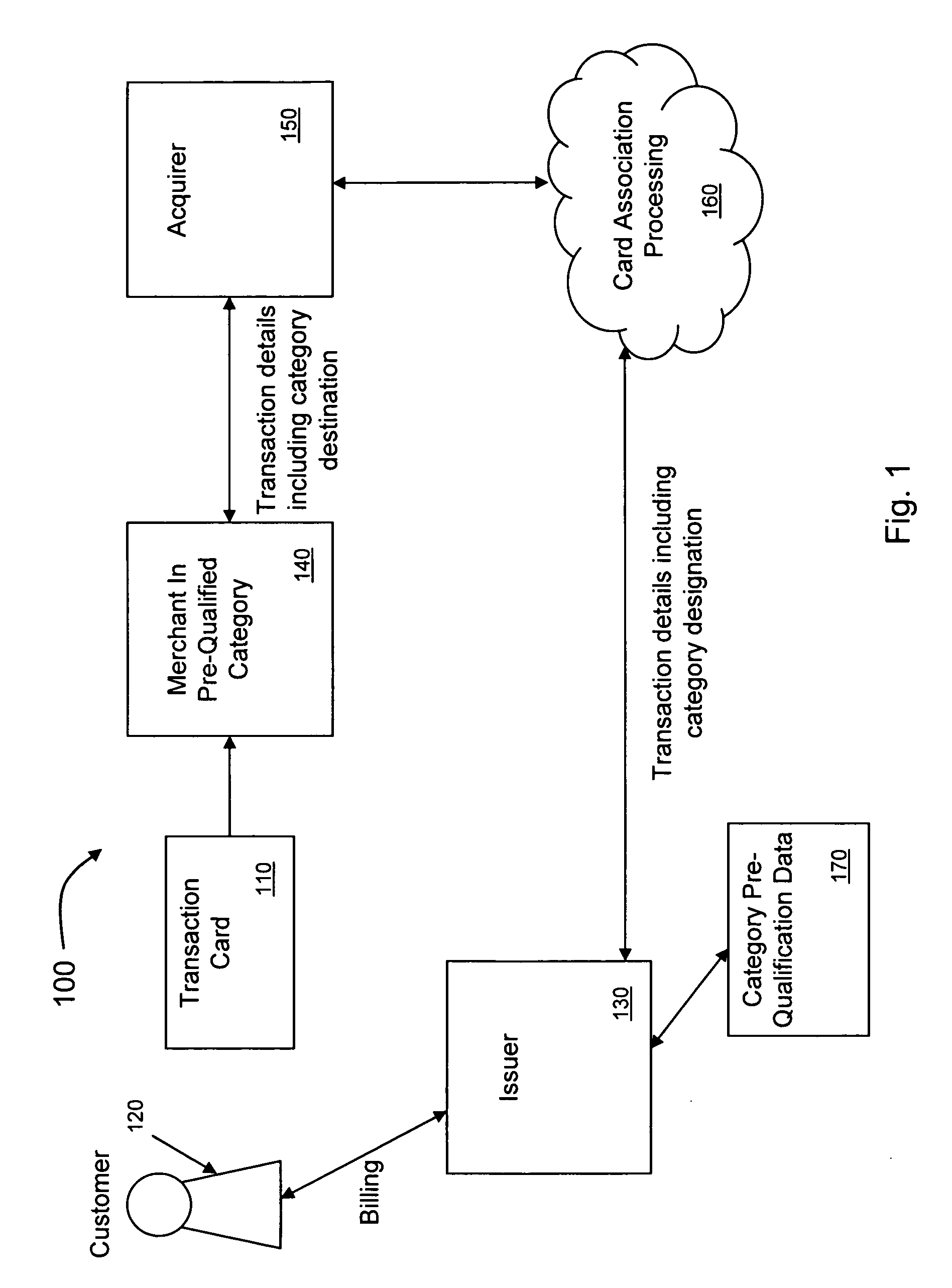

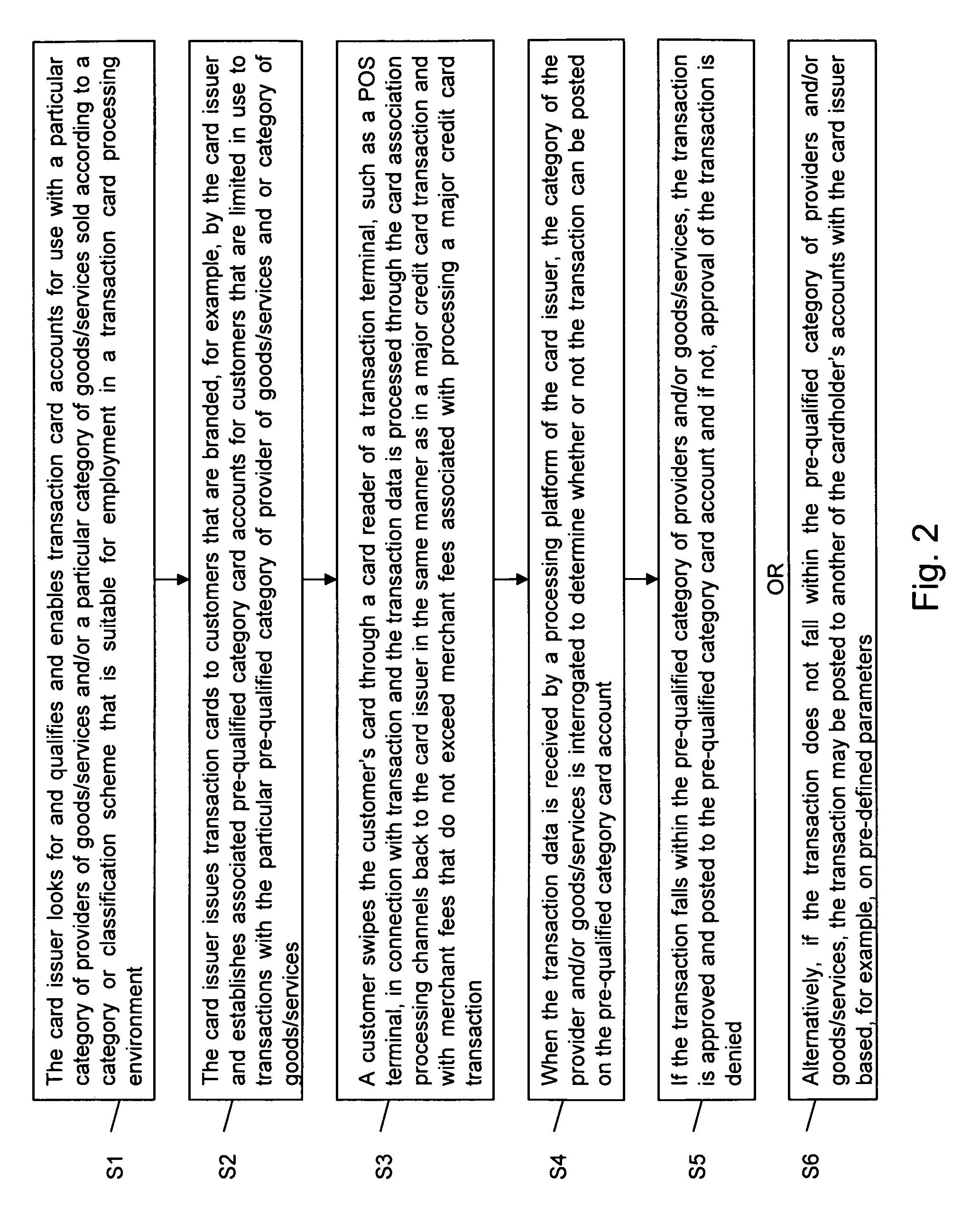

Methods and systems for managing transaction card accounts enabled for use with particular categories of providers and/or goods/services

A computer-implemented method and system for managing transaction card accounts involves enabling a transaction card account by a card issuer for use with pre-defined categories of providers of goods / services and goods / services sold and issuing a transaction card and establishing an associated pre-qualified category card account. Upon receiving data for a transaction with the transaction card at a transaction terminal by a processing platform of the card issuer via a card association processing network, the category of the provider and goods / services is interrogated to determine whether or not the transaction can be posted on the pre-qualified category card account of the cardholder, and the transaction is approved and posted to the pre-qualified category card account if the transaction falls within the pre-qualified category of the cardholder.

Owner:CITICORP CREDIT SERVICES INC (USA)

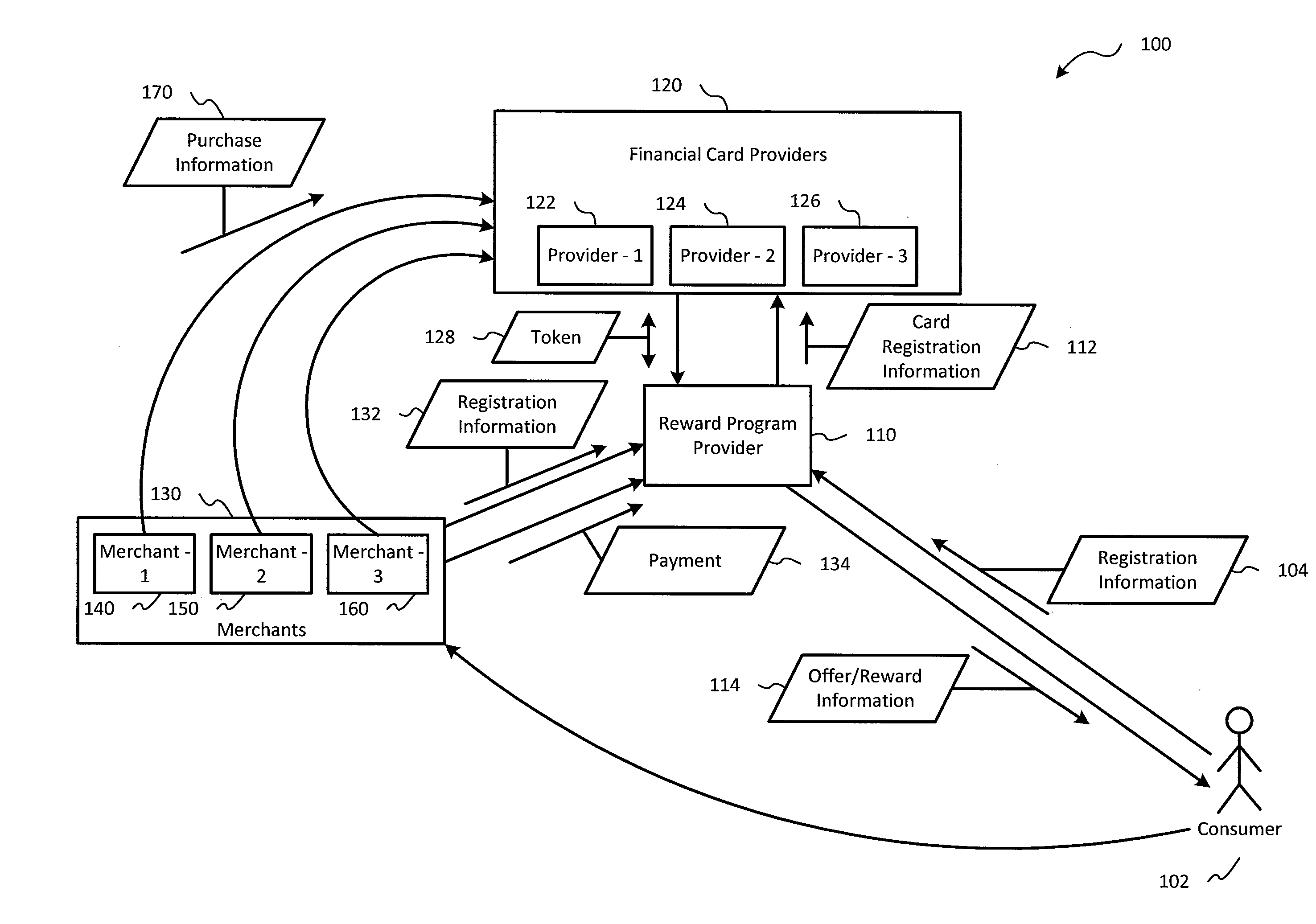

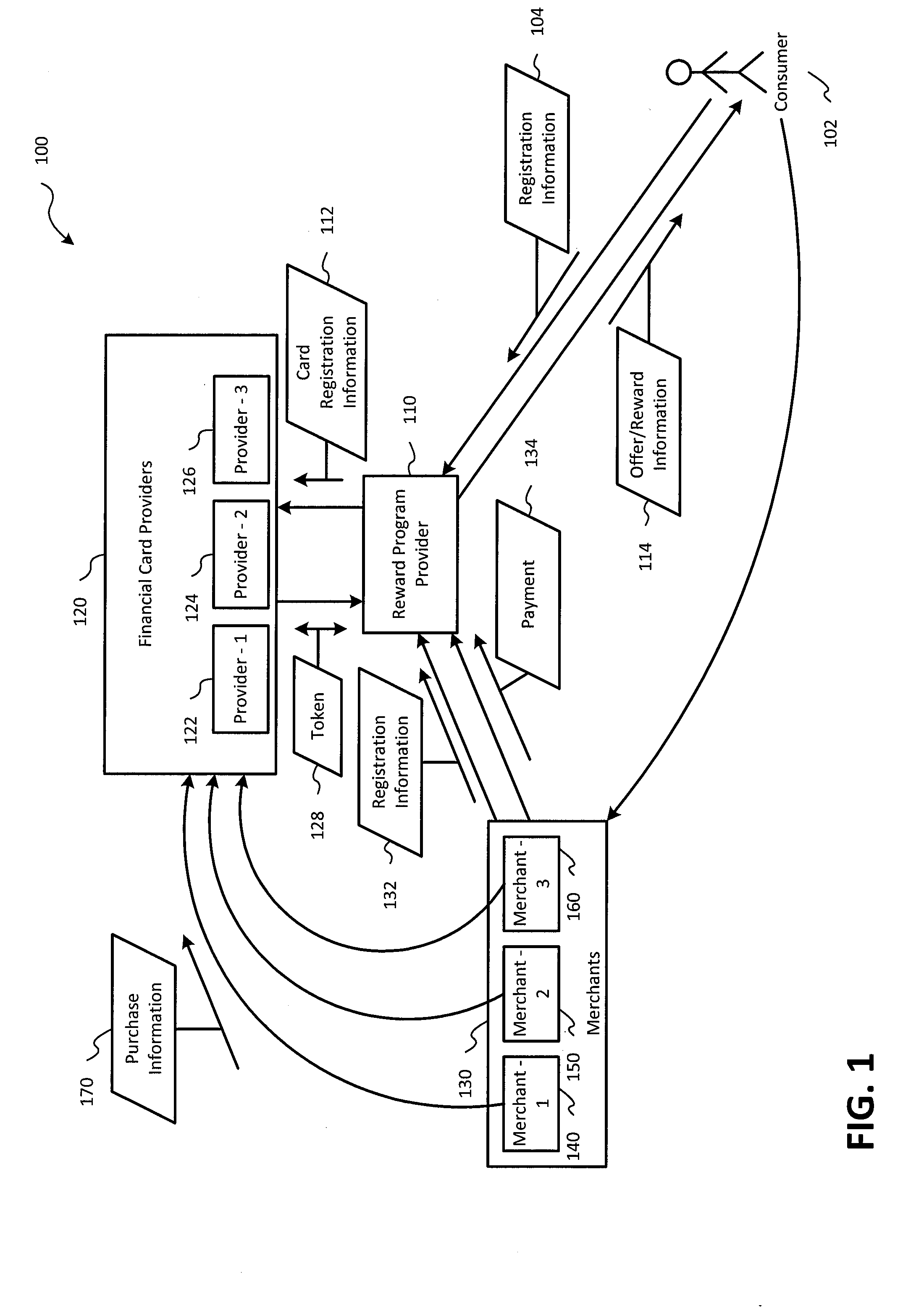

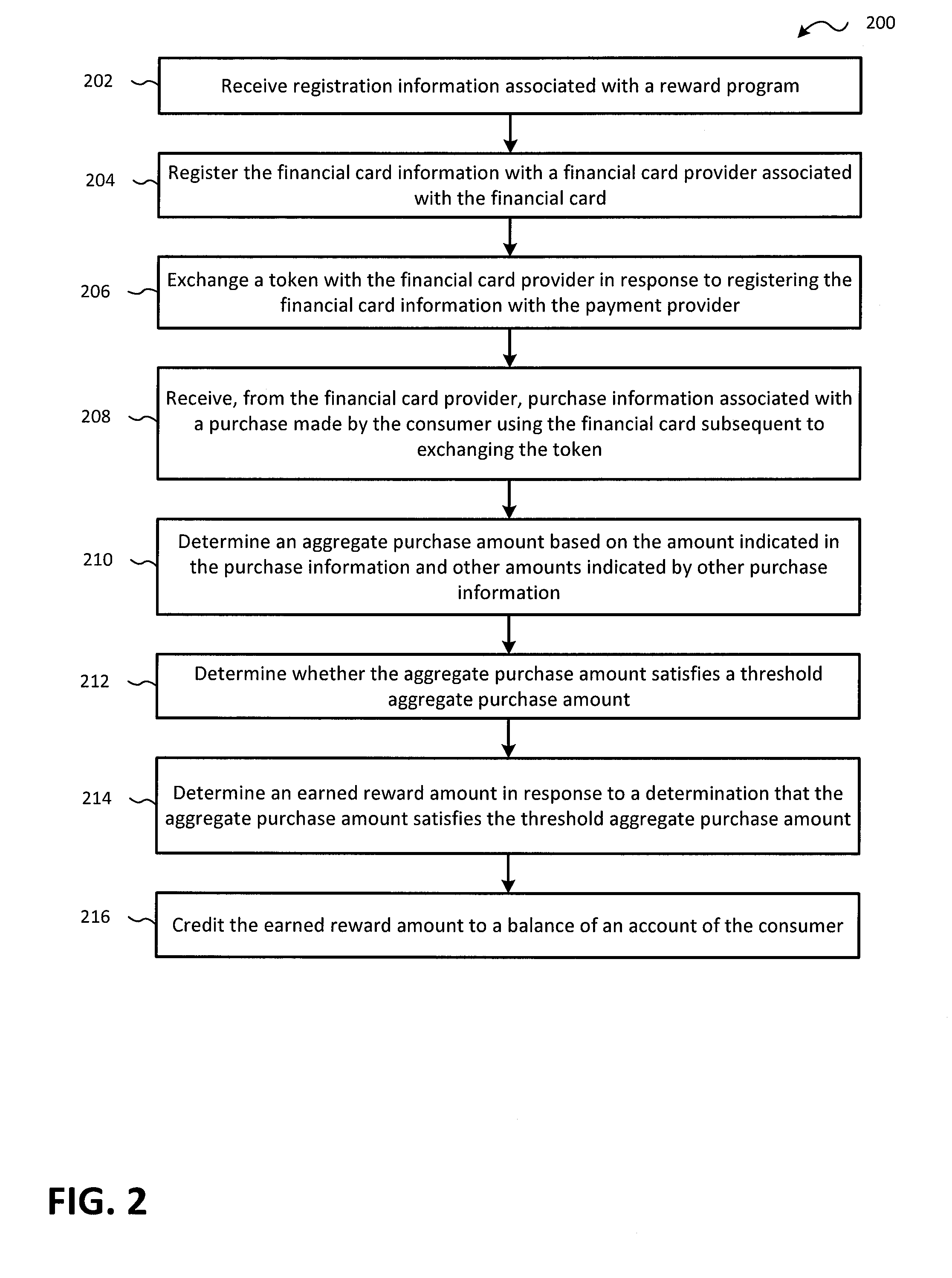

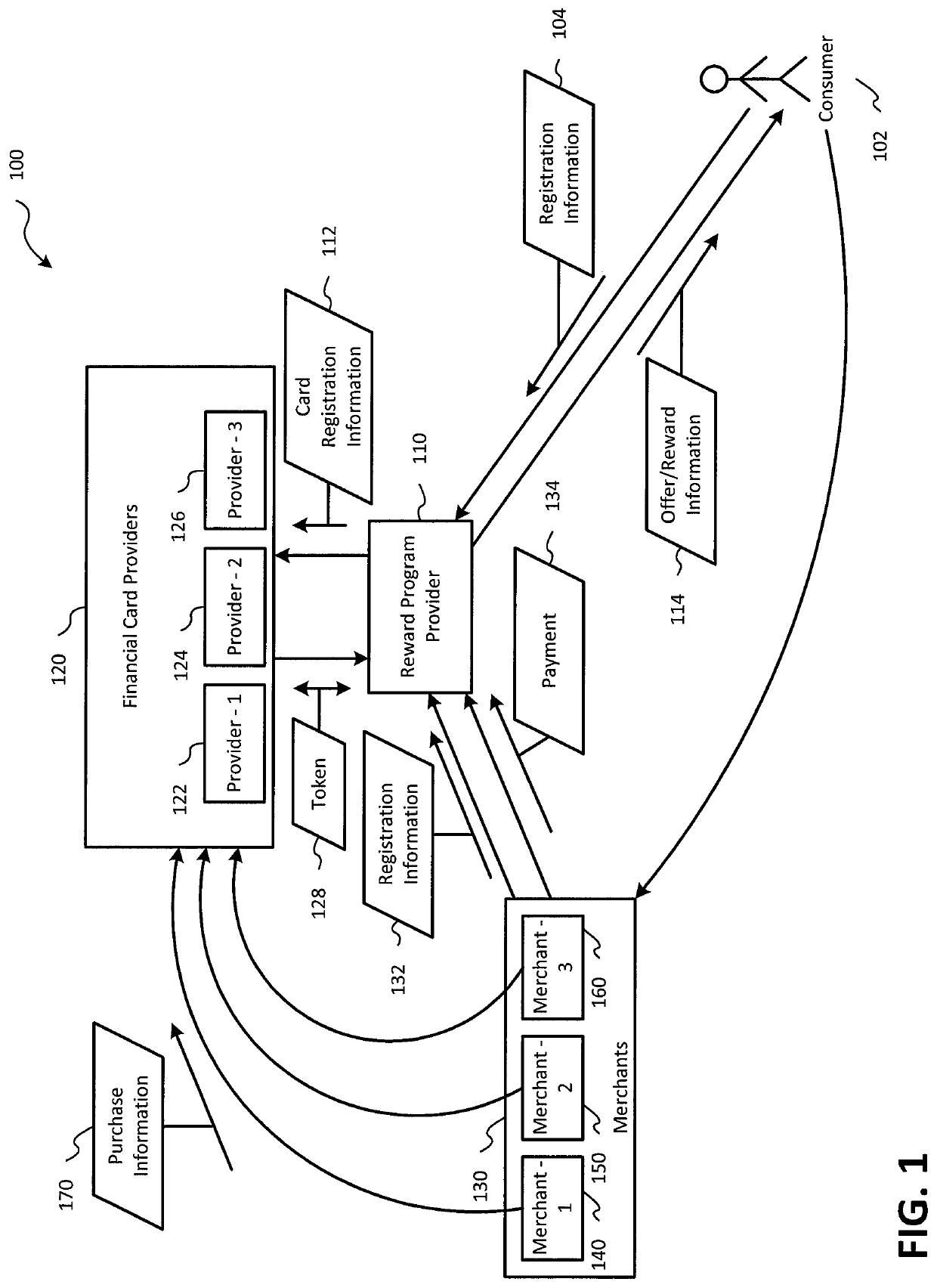

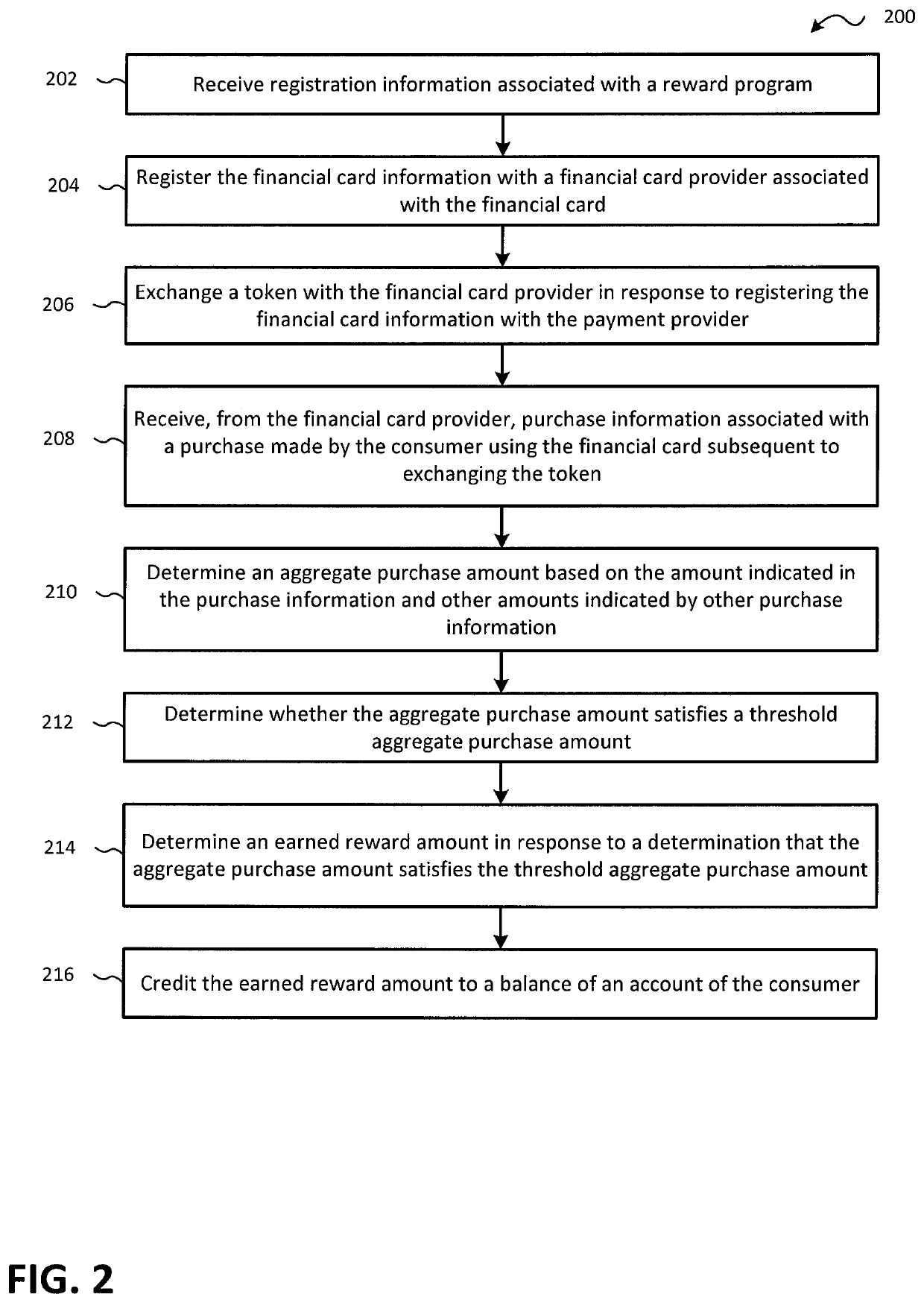

Systems and methods for discounting the price of goods and services to a consumer based on purchases made by the consumer at a plurality of merchants using a plurality of financial cards

ActiveUS20160225007A1Address rising pricesReduce the possibilityMarketingCard associationComputer science

The present disclosure is related to discounting a price of commodities to a consumer based on purchases made by the consumer with a financial card. A consumer registers with a reward program by providing information associated with a financial card to a reward program provider. The reward program provider may validate the financial card with a financial card provider (e.g., a card association), and, in response to a successful validation of the financial card, may receive, from the financial card provider, a token that may be used to identify purchases made by the consumer using the financial card, and the reward program provider may delete the financial information provided by the consumer during the registration process. The reward program provider may receive information that includes the token and indicates purchases made by the consumer and is used to determine rewards earned by the consumer.

Owner:EXCENTUS CORP

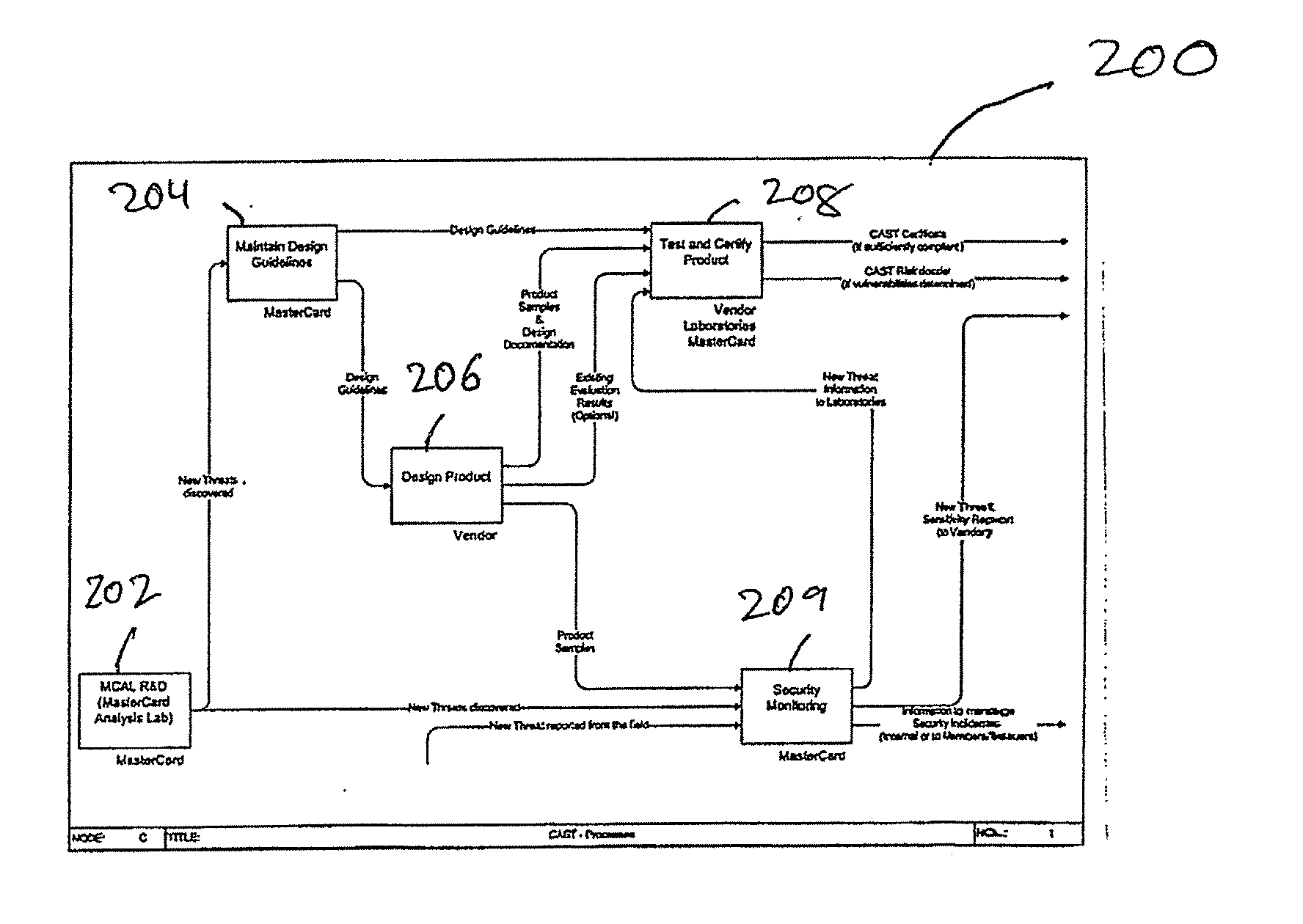

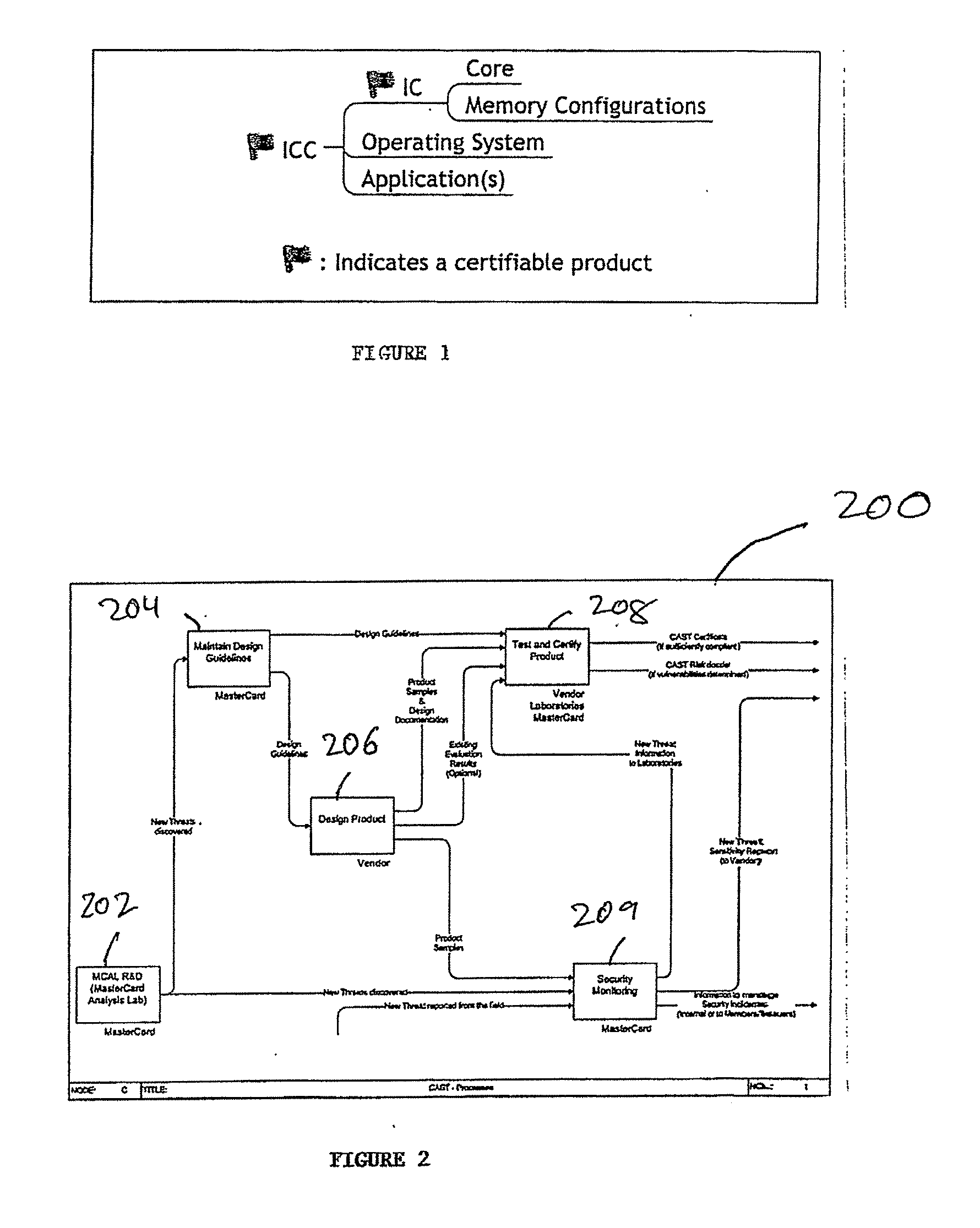

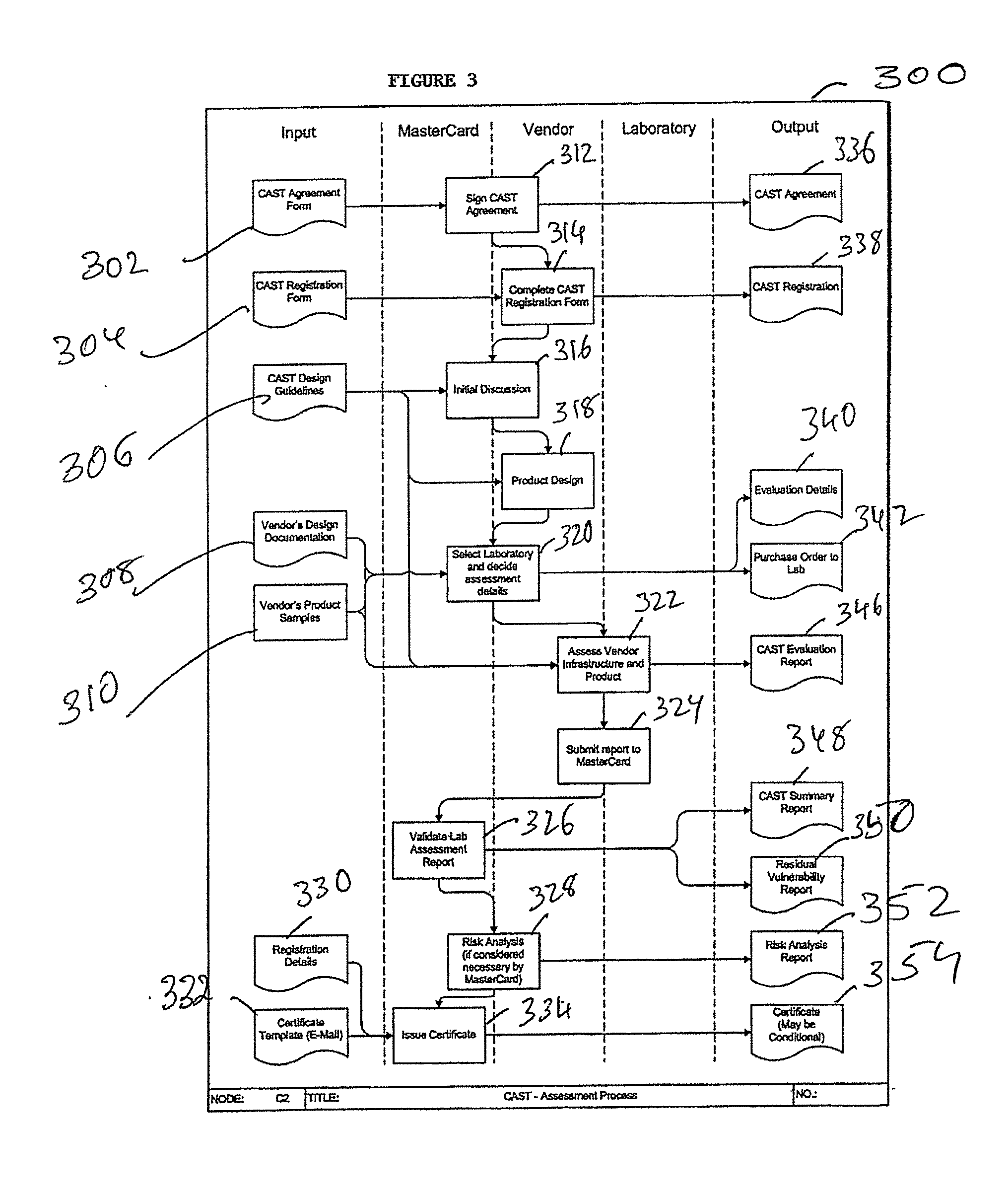

Compliance Assessment And Security Testing Of Smart Cards

A compliance assessment and security testing process provides assurance that a vendor's smart card product complies with a card association's security guidelines and is approved for use in a smart card electronic payment system under a card association's brand name. A certificate of compliance is assigned to the product if approved. The security guidelines are updated as new security threats and developing attack potential are recognized and product certifications are accordingly updated. When security vulnerabilities are discovered in the vendor's smart card product, risk analysis is conducted to determine if the vulnerabilities pose an unacceptable level of risk to the member banks.

Owner:MASTERCARD INT INC

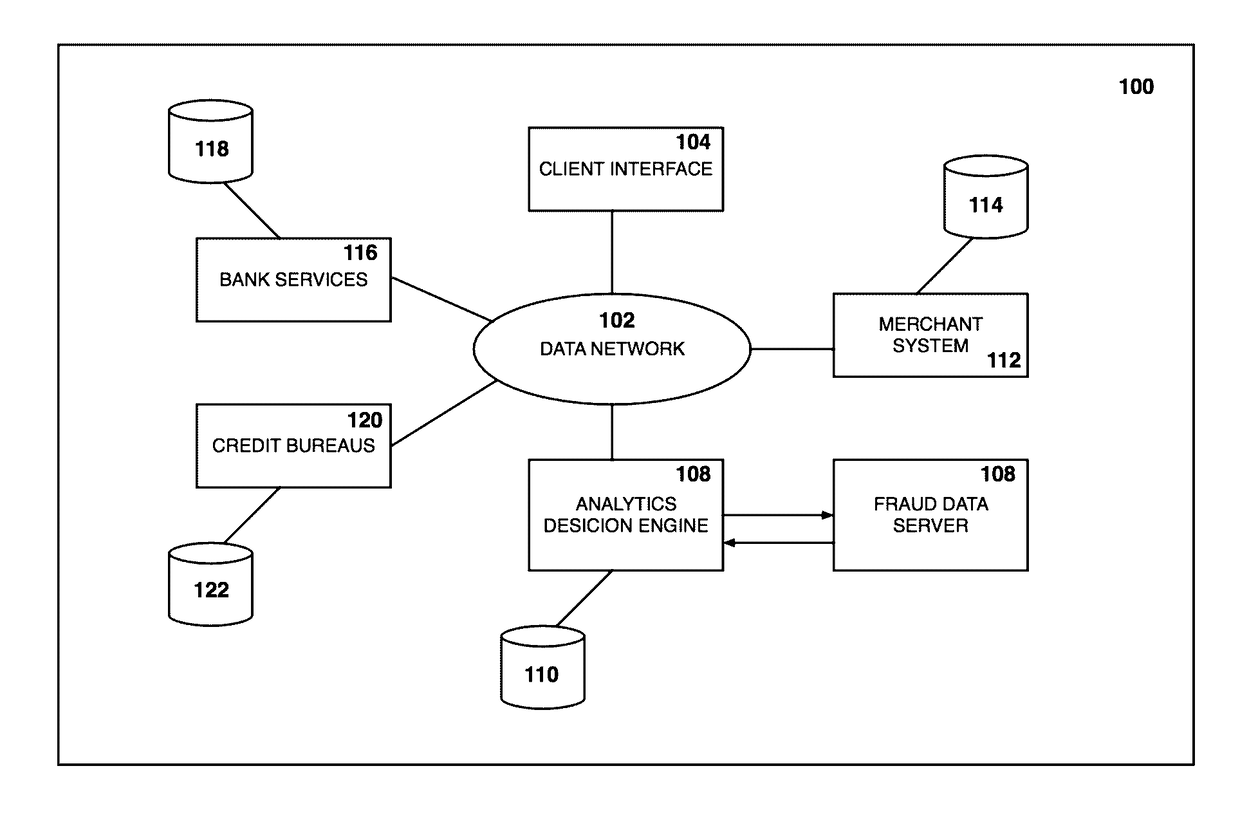

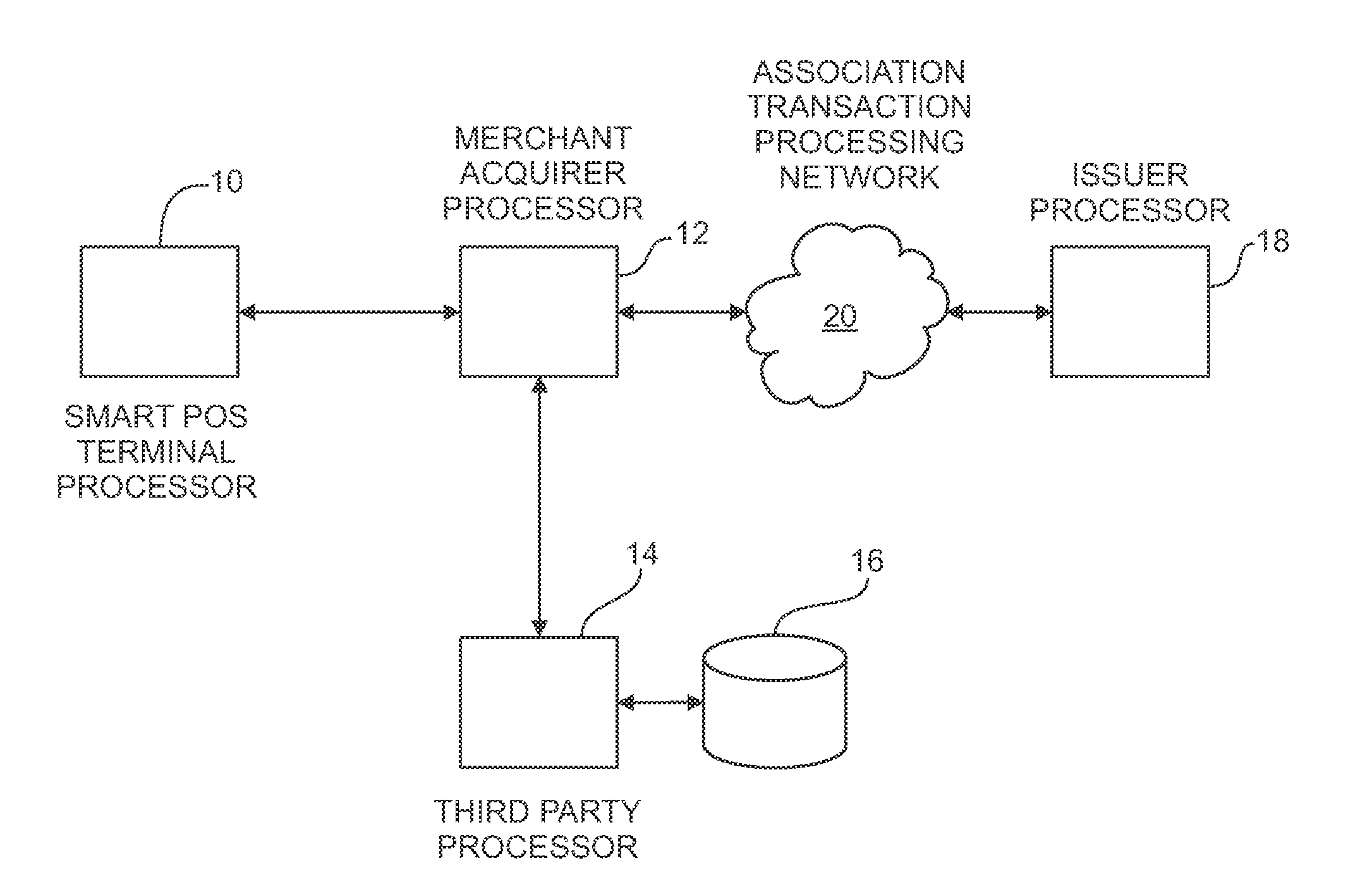

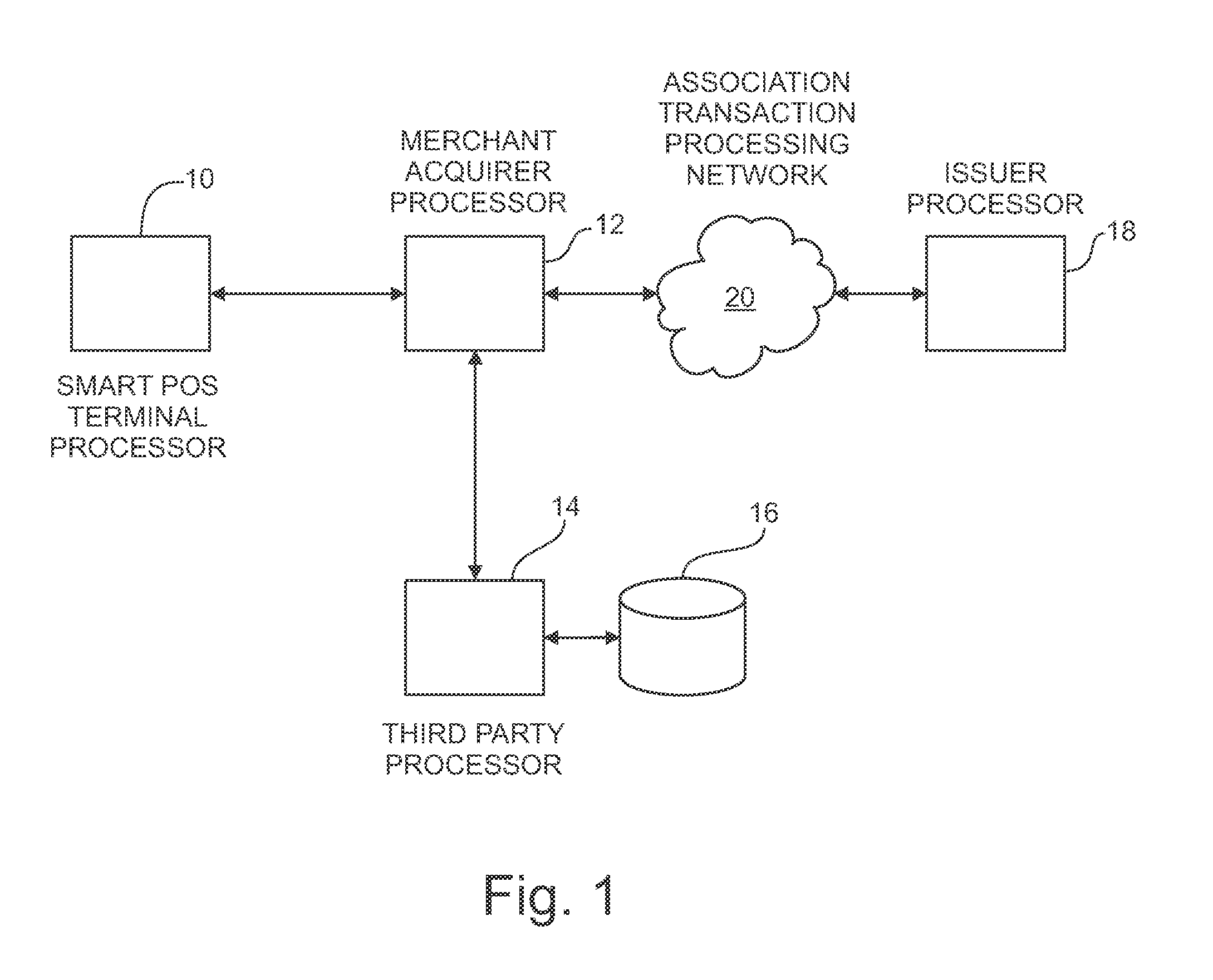

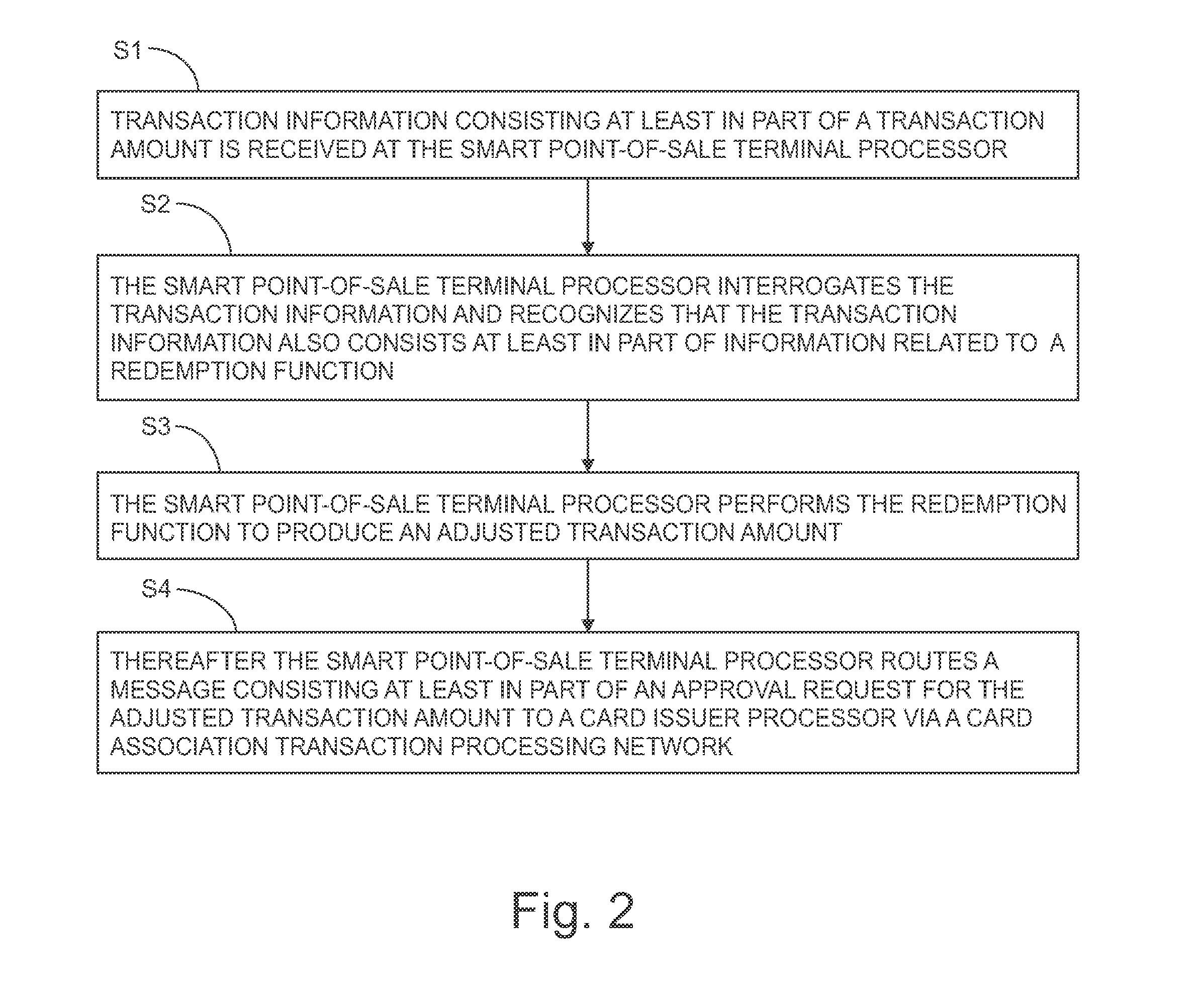

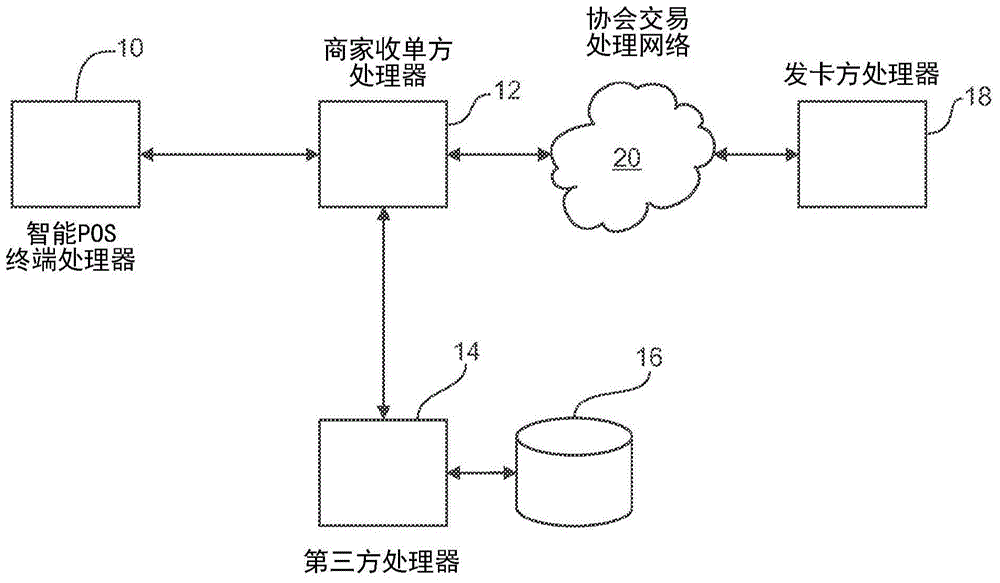

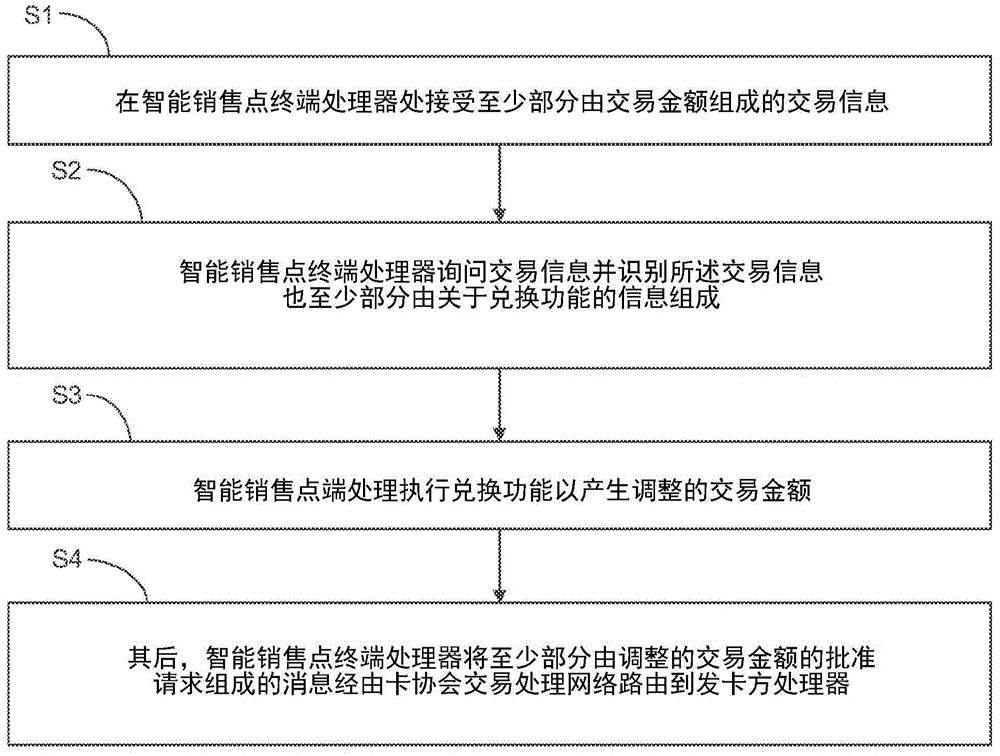

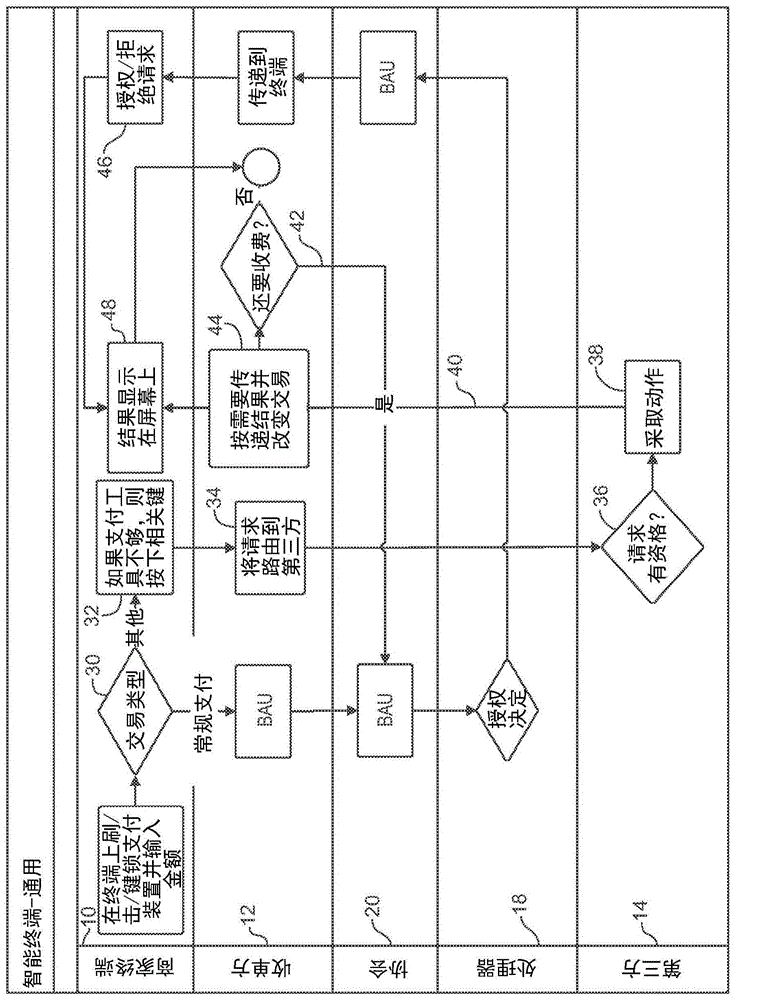

Methods and Systems for Communicating Information from a Smart Point-of-Sale Terminal

Methods and systems for communicating information from a specially programmed smart point-of-sale terminal involve receiving transaction information at the terminal, recognizing that the transaction relates to a redemption function, adjusting the transaction amount accordingly, and routing an approval request for the adjusted amount to a card issuer processor via a card association transaction processing network. In another aspect, information is received at the terminal which recognizes that the information relates to a third party function and routes a message to the third party processor via a merchant acquirer processor while bypassing the card association transaction processing network. Thereafter, the third party processor performs the third party function and returns a message related at least in part to the performance of the third party function to the smart point-of-sale terminal processor via the merchant acquirer processor.

Owner:CITIBANK

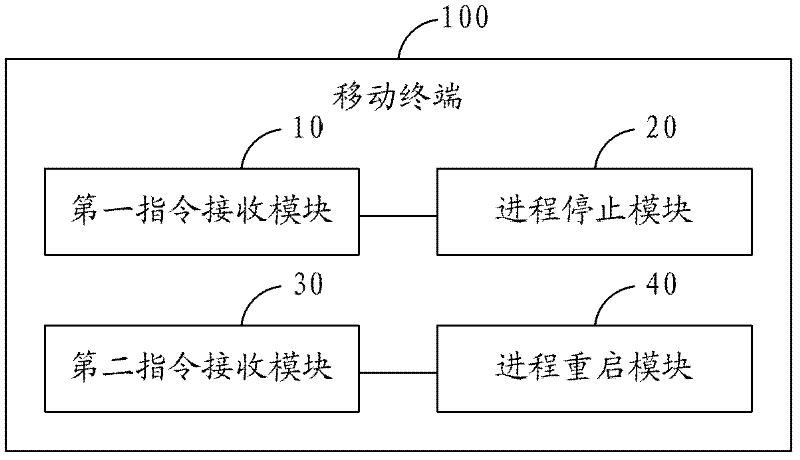

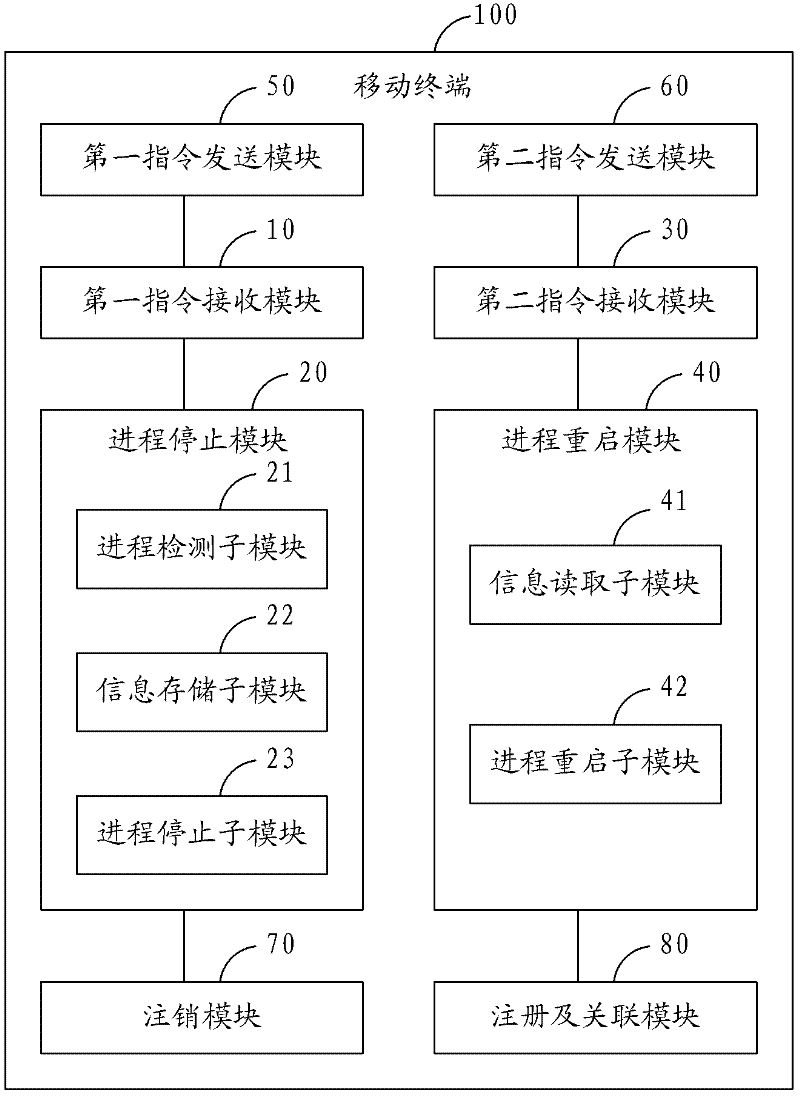

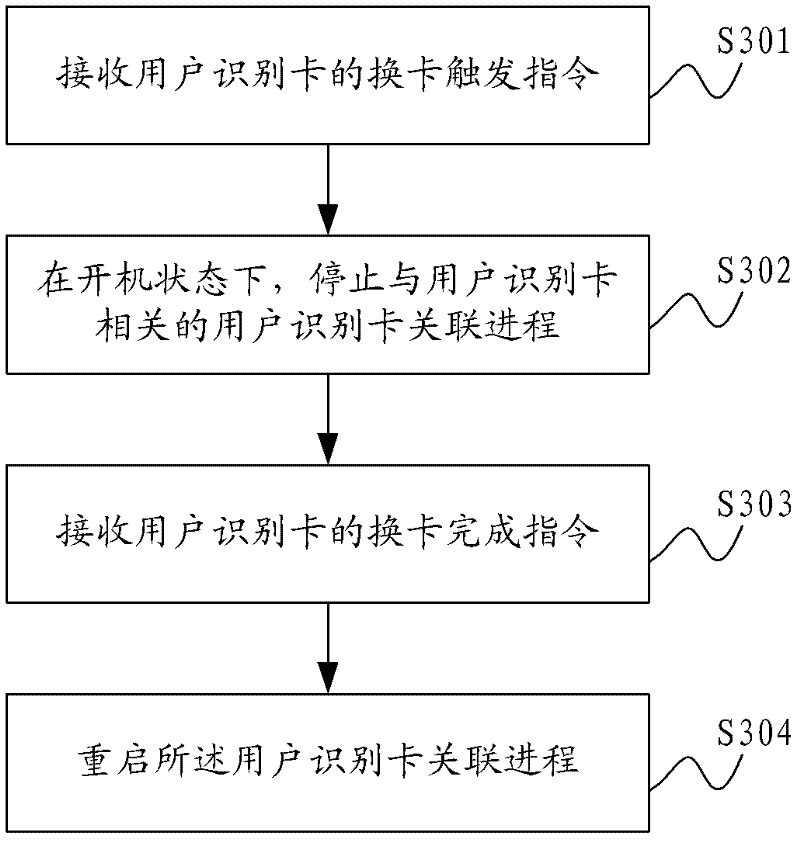

Method for replacing subscriber identification card of mobile terminal and mobile terminal

InactiveCN102421174AIncrease battery power consumptionExtend standby timePower managementHigh level techniquesComputer hardwareCard association

The invention is applicable to the technical field of communication and provides a method for replacing a subscriber identification card of a mobile terminal. The method comprises the following steps of: receiving a card replacement trigger instruction of the subscriber identification card; in a starting state, stopping a subscriber identification card association process which is associated with the subscriber identification card; receiving a card replacement finishing instruction of the subscriber identification card; and re-starting the subscriber identification card association process. Correspondingly, the invention also provides the mobile terminal. Therefore, by the invention, replacement of the subscriber identification card in the starting state of the mobile terminal can be realized, so that operation convenience and quickness are improved.

Owner:YULONG COMPUTER TELECOMM SCI (SHENZHEN) CO LTD

System and method for facilitating large scale payment transactions

InactiveUS8234214B2Facilitating electronic payment(s)Convenient and efficient mannerFinanceMultiple digital computer combinationsPayment transactionInternet privacy

Owner:NOVENTIS

Methods and systems for managing transaction card accounts enabled for use with particular categories of providers and/or goods/services

Owner:CITICORP CREDIT SERVICES INC (USA)

Methods and systems for managing transaction card accounts enabled for use with particular categories of providers and/or goods/services

A computer-implemented method and system for managing transaction card accounts involves enabling a transaction card account by a card issuer for use with pre-defined categories of providers of goods / services and goods / services sold and issuing a transaction card and establishing an associated pre-qualified category card account. Upon receiving data for a transaction with the transaction card at a transaction terminal by a processing platform of the card issuer via a card association processing network, the category of the provider and goods / services is interrogated to determine whether or not the transaction can be posted on the pre-qualified category card account of the cardholder, and the transaction is approved and posted to the pre-qualified category card account if the transaction falls within the pre-qualified category of the cardholder.

Owner:CITICORP CREDIT SERVICES INC (USA)

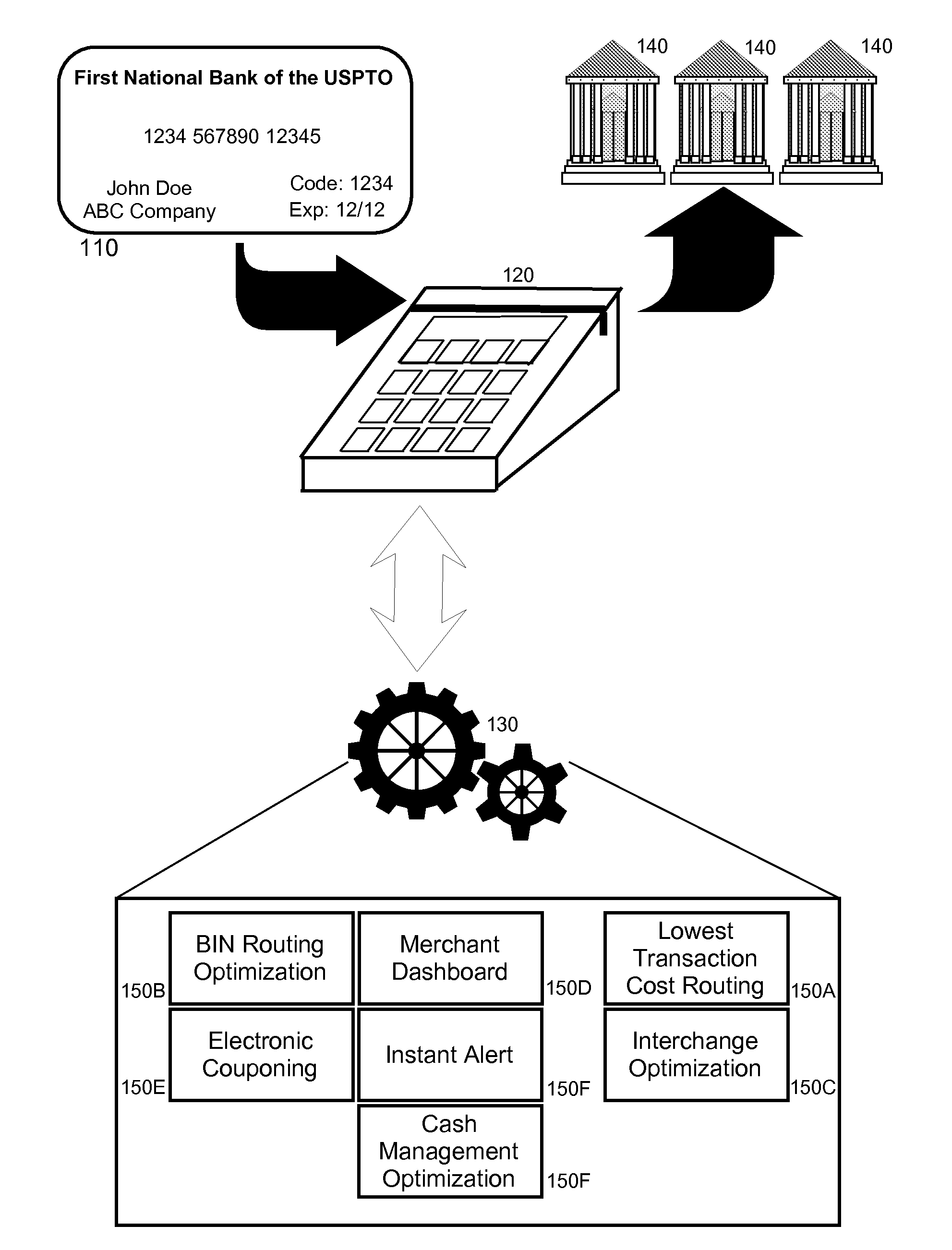

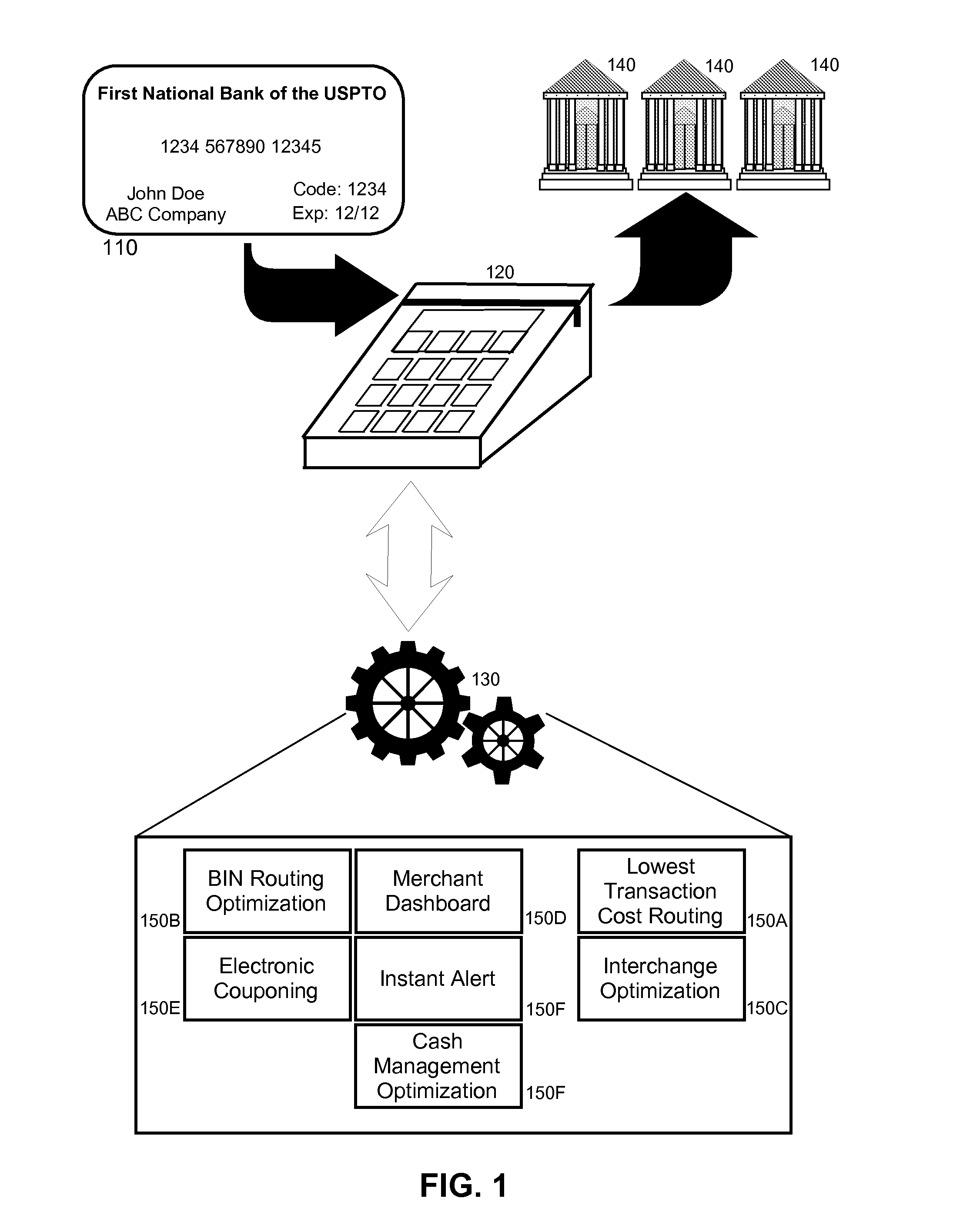

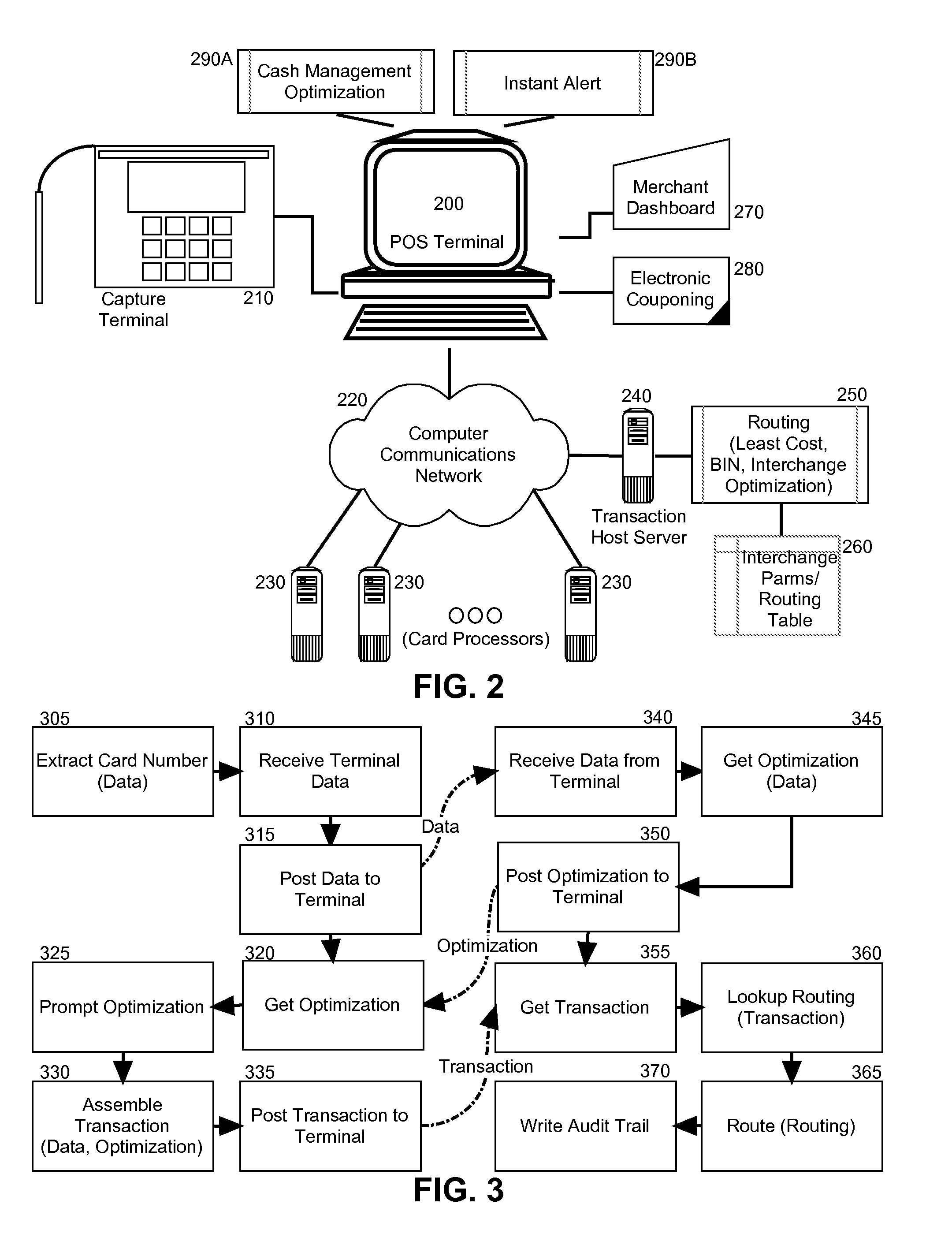

Interchange optimization for payment processing

Embodiments of the present invention provide a method, system and computer program product for interchange optimization for payment processing. In an embodiment of the invention, an interchange optimization method for payment processing can include receiving a transaction profile for a proposed transaction as payment for a purchase by a purchaser from a merchant at a card processing terminal configured to identify a card number for a card. The method further can include determining a card association for the card number and retrieving criteria for a lowest interchange rate for the card association. The method yet further can include prompting the merchant to provide data required by the retrieved criteria and assembling a transaction for the proposed transaction with the required data. Finally, the method can include routing the assembled transaction to a selected payment processor.

Owner:CENPOS

Methods and systems for managing financial institution customer accounts

A computer-implemented method and system for managing financial institution customer transaction accounts involves issuing a relationship presentment card with a relationship identifier unique to the customer that is linked to a plurality of the customer's financial institution transaction accounts via pre-defined parameters for determining to which of the customer's linked accounts to post particular transactions with the relationship presentment card. Thereafter, when data for a transaction with the card is received by a processing platform of the financial institution via a merchant acquirer and a card association processing network, the card processing platform of the financial institution identifies a particular financial institution account of the customer to which the transaction should be posted according to the pre-defined parameters based on the transaction data and posts the transaction to the identified financial institution account of the customer.

Owner:CITICORP CREDIT SERVICES INC (USA)

Methods and systems for communicating information from a smart point-of-sale terminal

Methods and systems for communicating information from a specially programmed smart point-of-sale terminal involve receiving transaction information at the terminal, recognizing that the transaction relates to a redemption function, adjusting the transaction amount accordingly, and routing an approval request for the adjusted amount to a card issuer processor via a card association transaction processing network. In another aspect, information is received at the terminal which recognizes that the information relates to a third party function and routes a message to the third party processor via a merchant acquirer processor while bypassing the card association transaction processing network. Thereafter, the third party processor performs the third party function and returns a message related at least in part to the performance of the third party function to the smart point-of-sale terminal processor via the merchant acquirer processor.

Owner:CITIBANK

Systems and methods for discounting the price of goods and services to a consumer based on purchases made by the consumer at a plurality of merchants using a plurality of financial cards

ActiveUS10552860B2Reduce the possibilityAddress rising pricesMarketingCard associationComputer science

The present disclosure is related to discounting a price of commodities to a consumer based on purchases made by the consumer with a financial card. A consumer registers with a reward program by providing information associated with a financial card to a reward program provider. The reward program provider may validate the financial card with a financial card provider (e.g., a card association), and, in response to a successful validation of the financial card, may receive, from the financial card provider, a token that may be used to identify purchases made by the consumer using the financial card, and the reward program provider may delete the financial information provided by the consumer during the registration process. The reward program provider may receive information that includes the token and indicates purchases made by the consumer and is used to determine rewards earned by the consumer.

Owner:EXCENTUS CORP

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com