Patents

Literature

99 results about "Chargeback" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

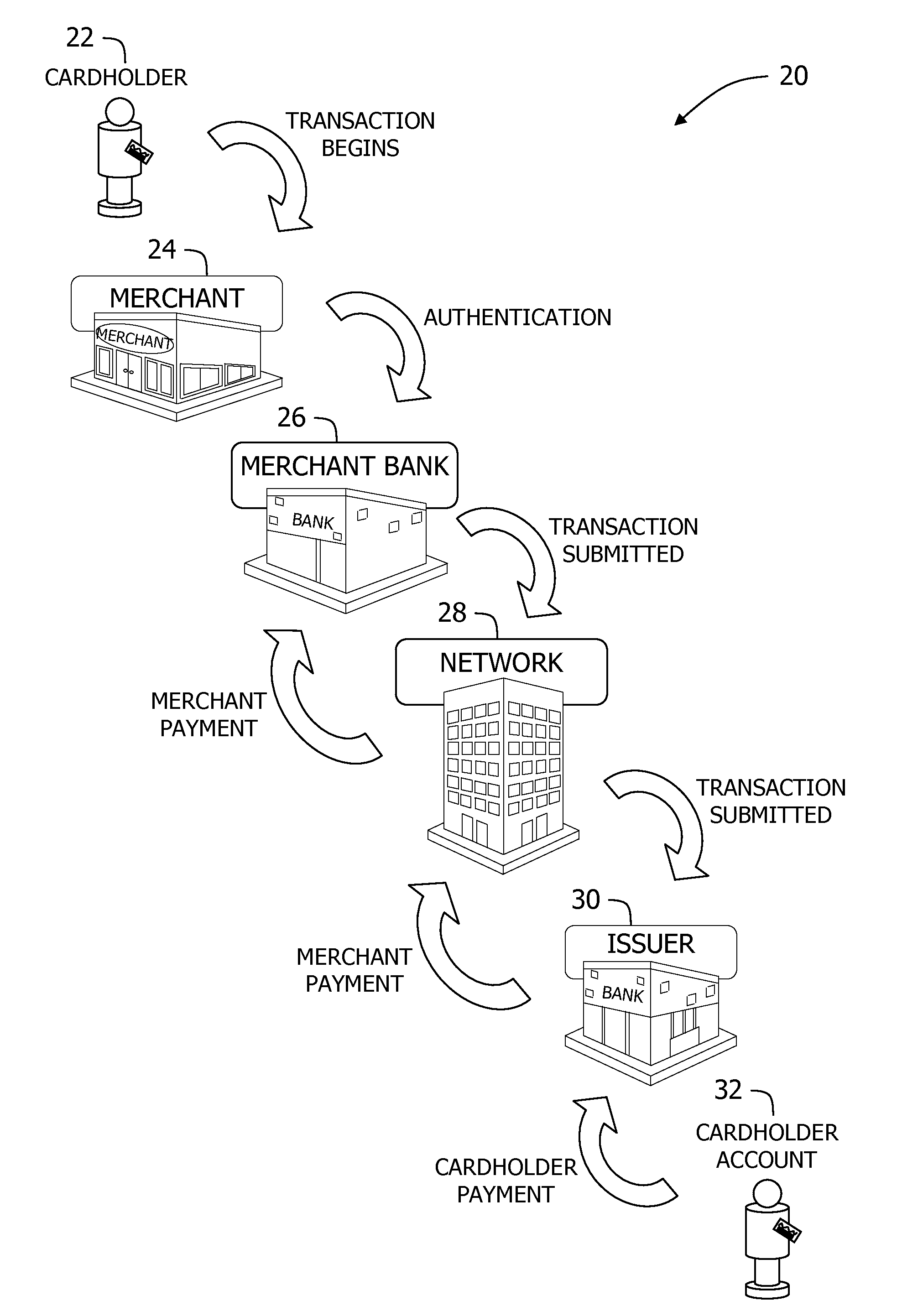

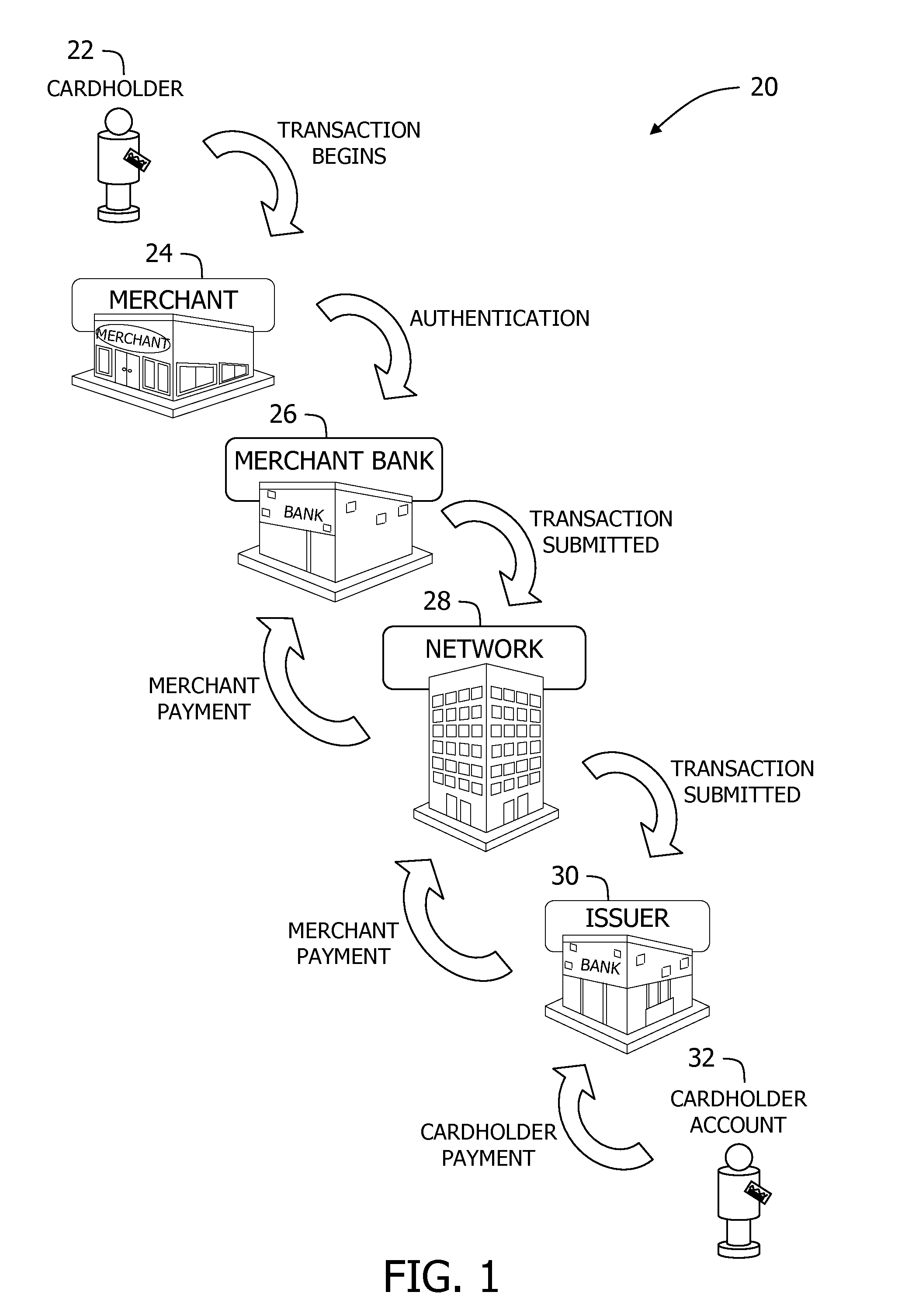

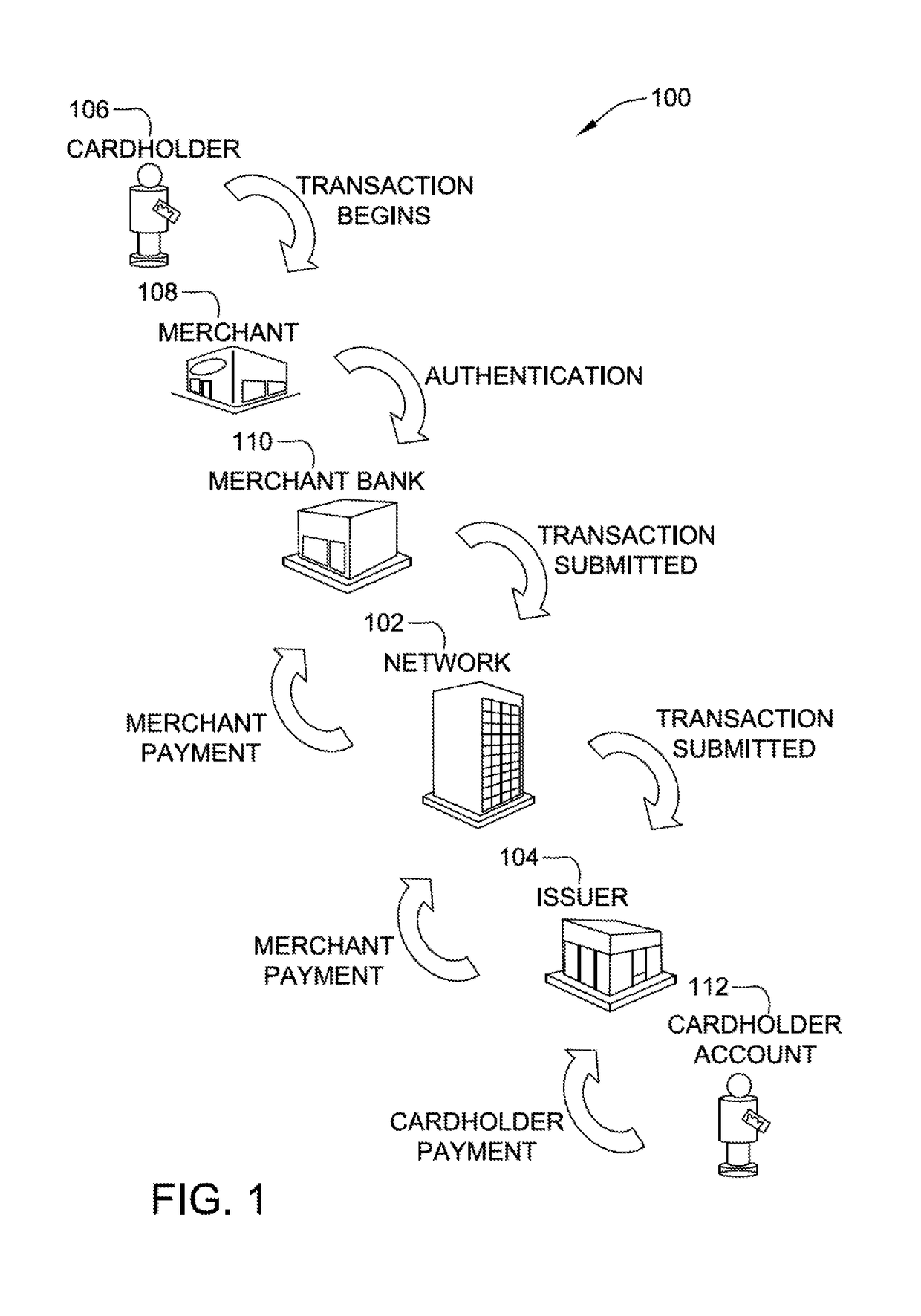

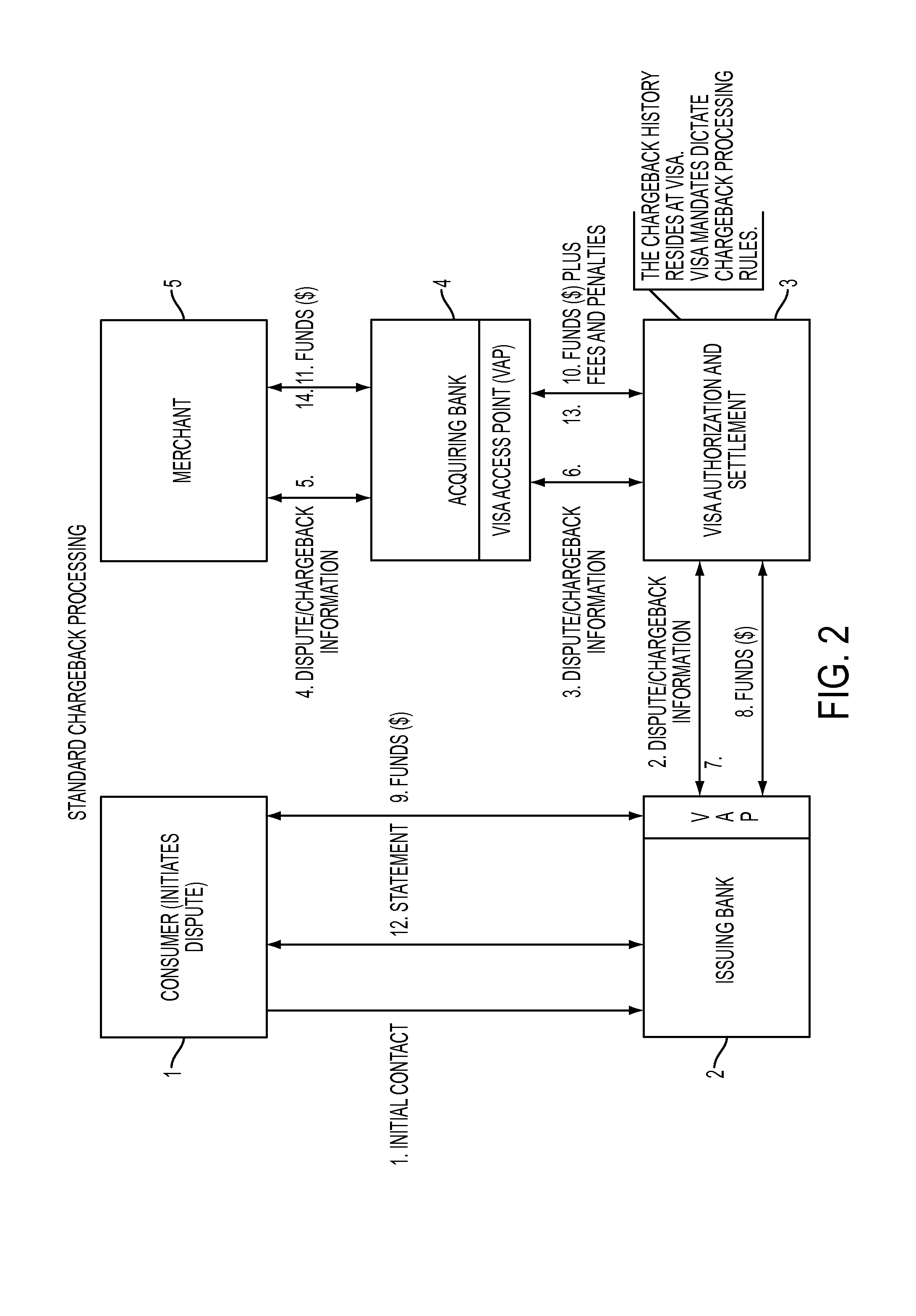

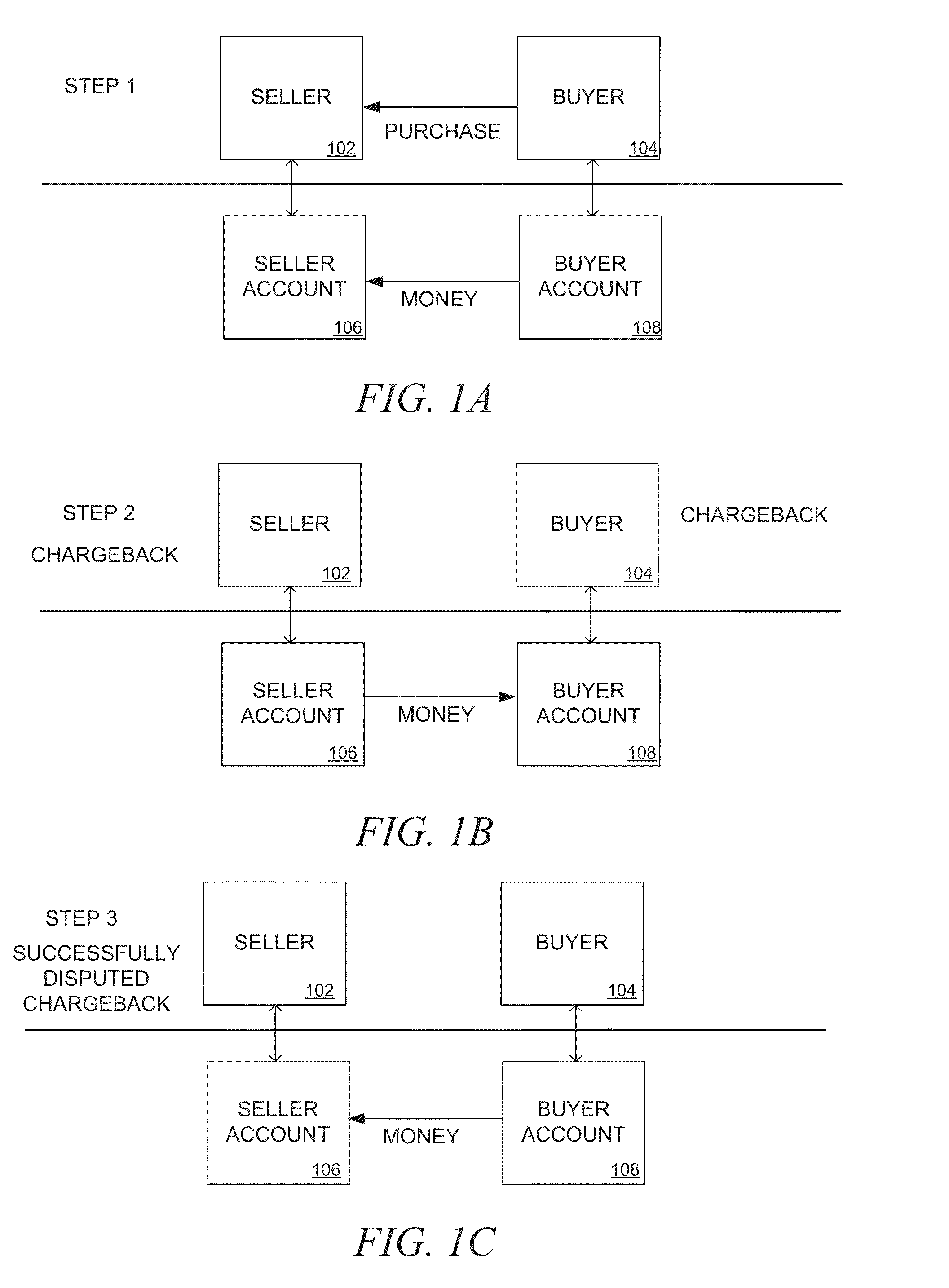

Chargeback is the return of funds to a consumer, initiated by the issuing bank of the instrument used by a consumer to settle a debt. Specifically, it is the reversal of a prior outbound transfer of funds from a consumer's bank account, line of credit, or credit card.

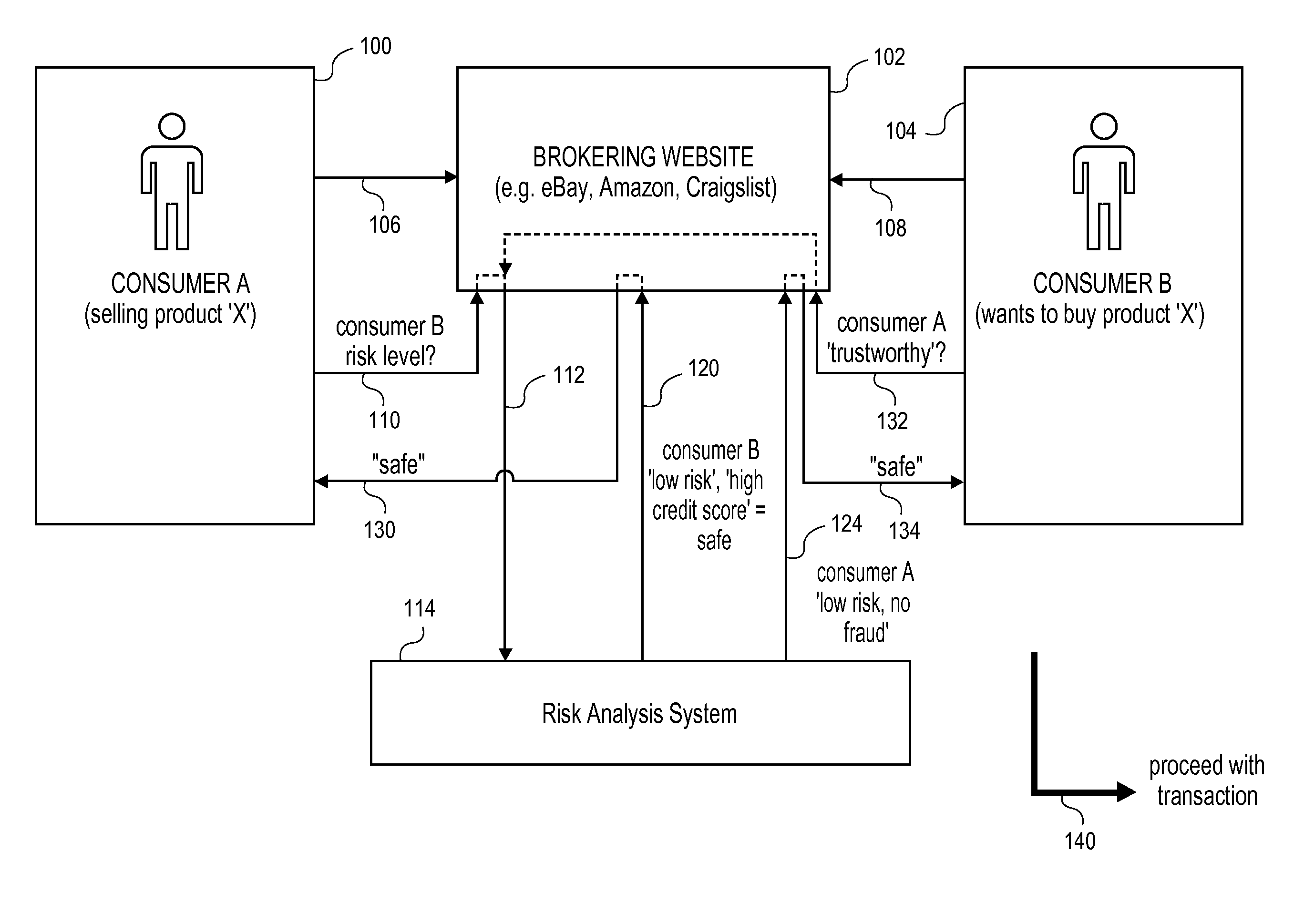

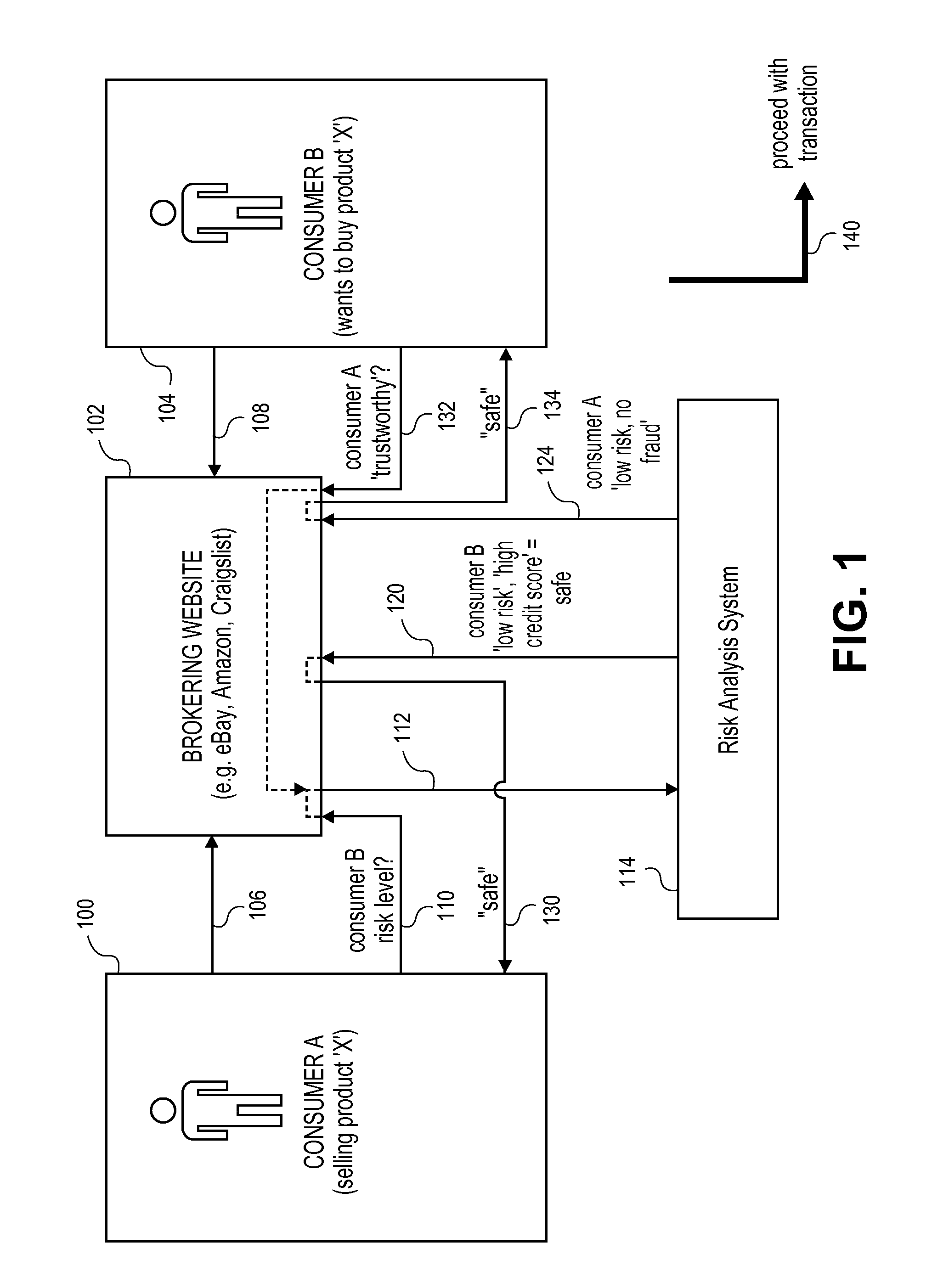

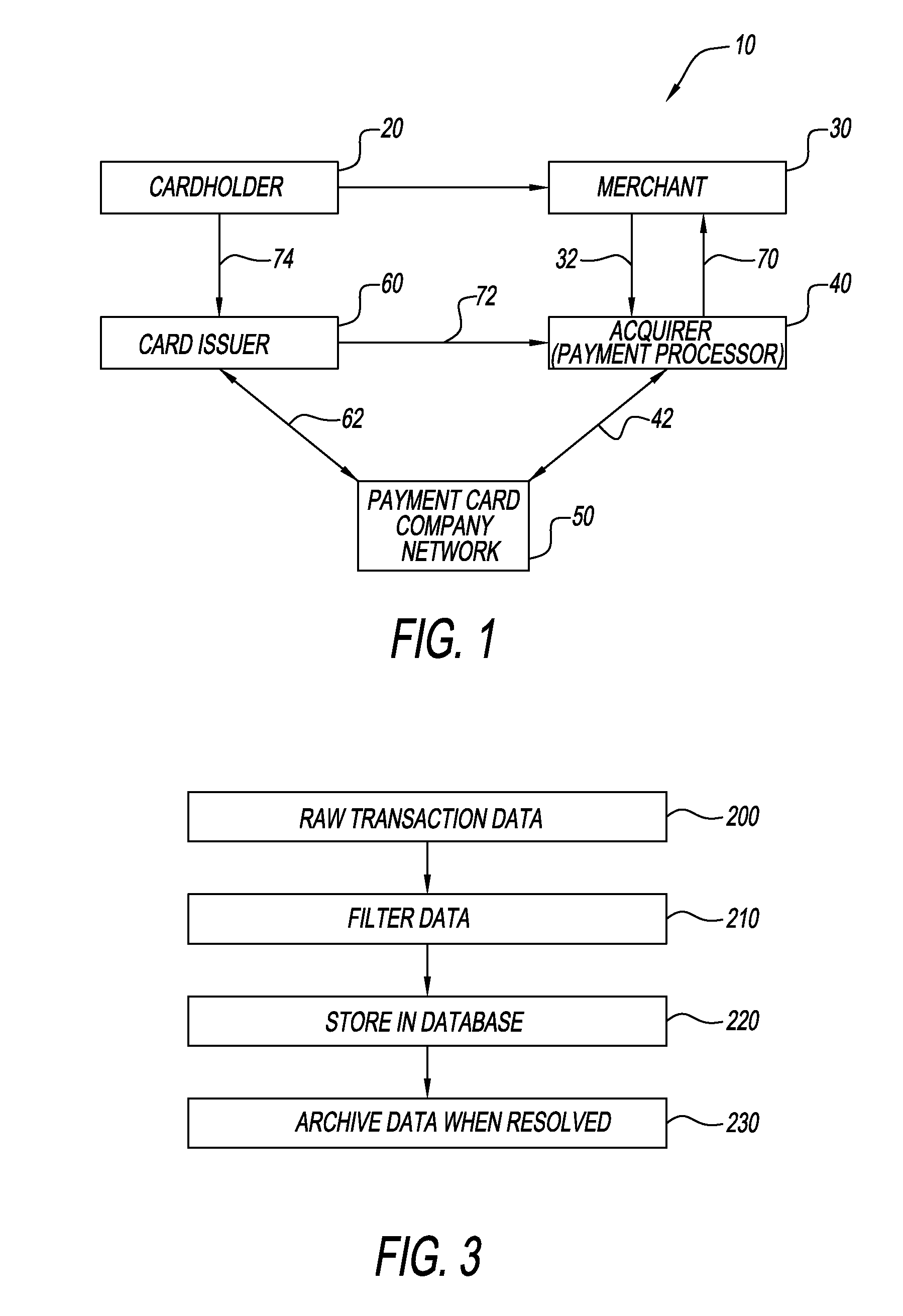

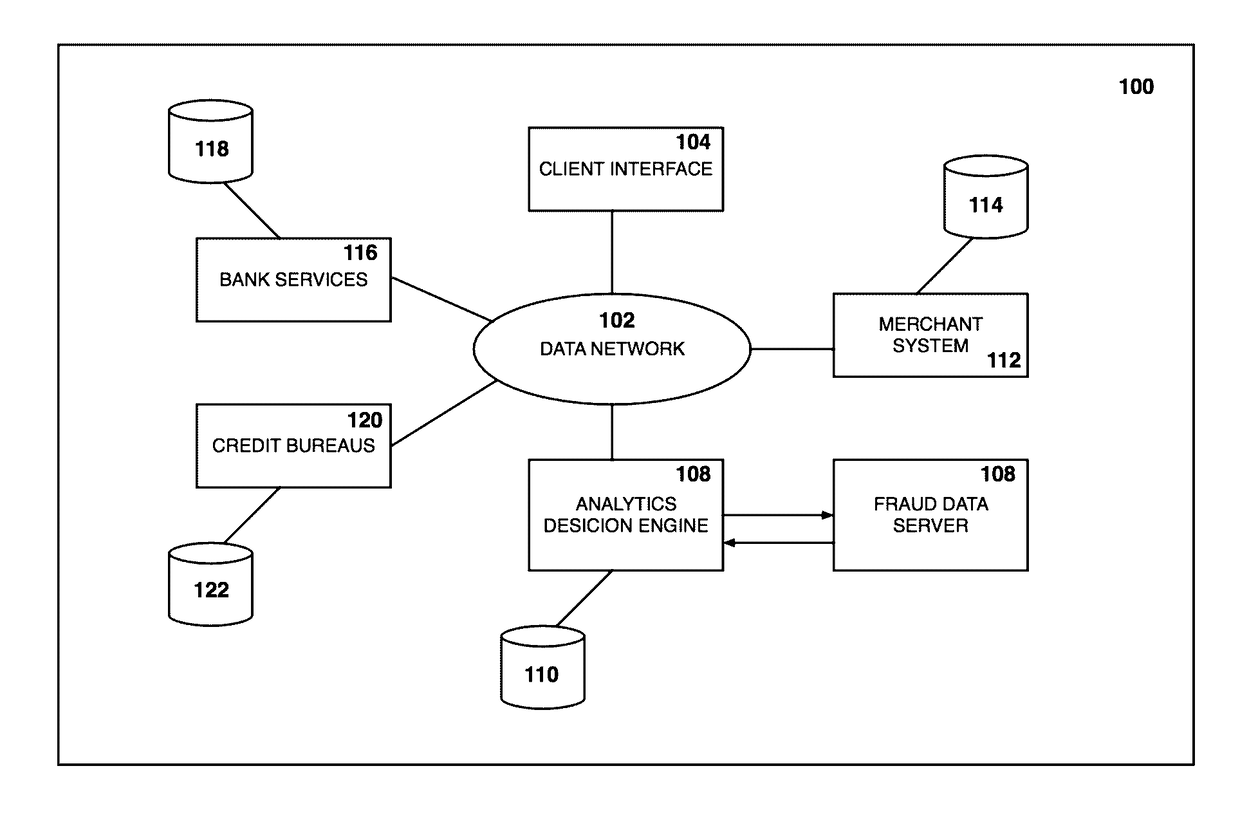

Transaction data repository for risk analysis

ActiveUS20110184838A1Convenient transactionDispel doubtsFinancePayment architectureIp addressGeolocation

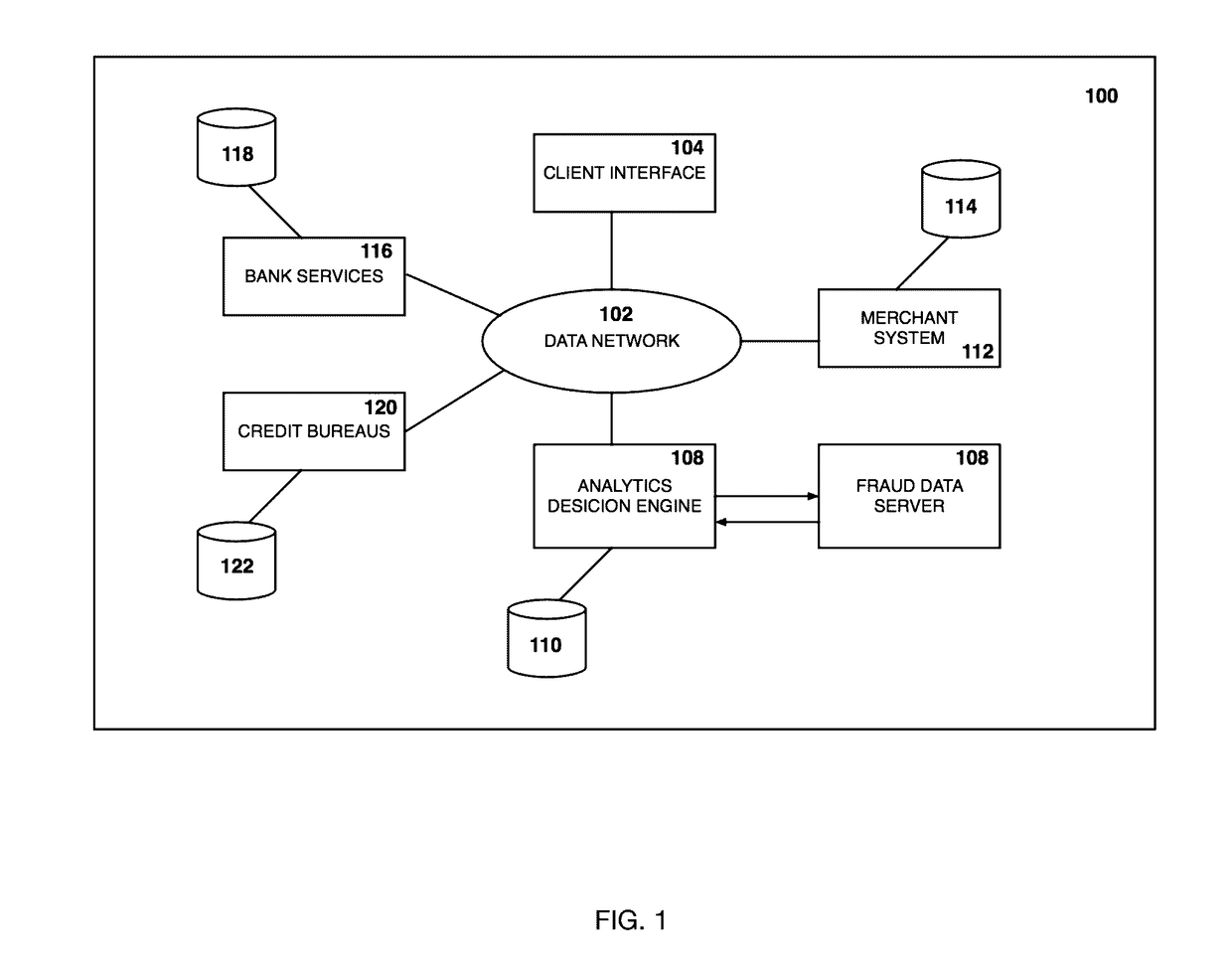

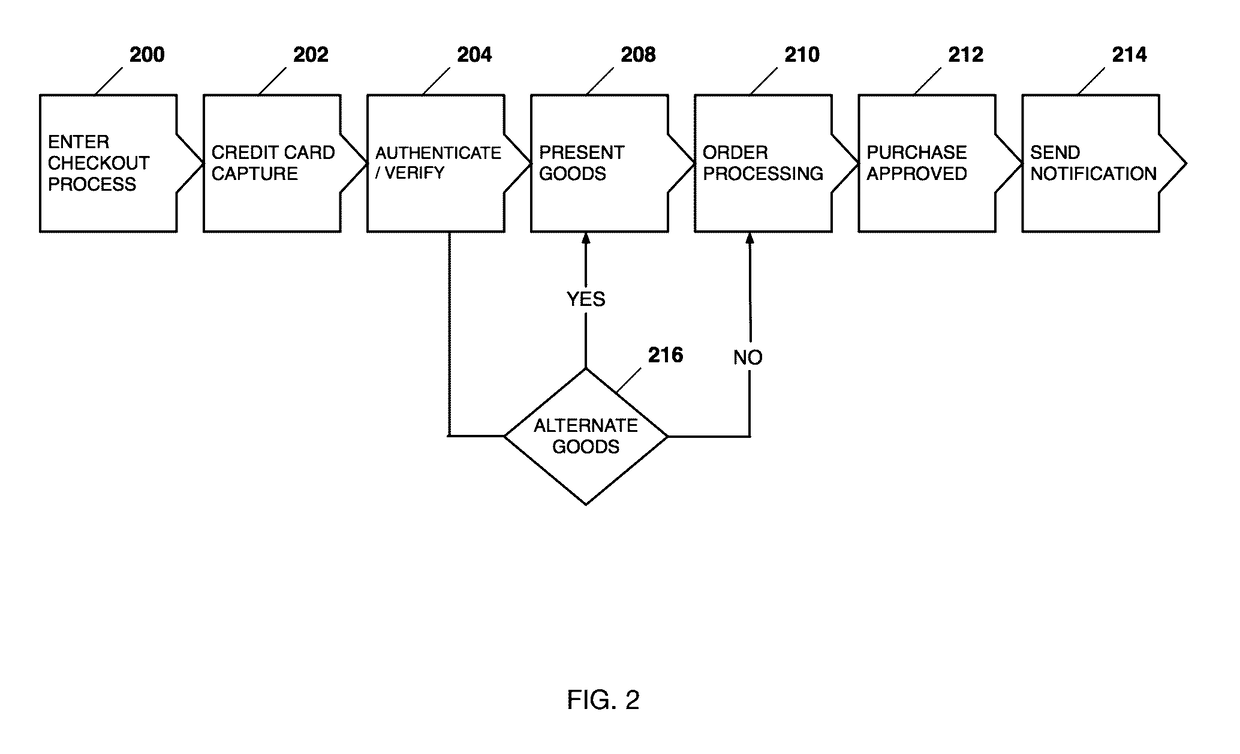

Systems and methods are presented for determining risk levels for consumer-to-consumer (C2C) transactions on brokering websites. The risk levels can be based on payment processing network (e.g. Visa) account data as well as external data, such as geo-location using IP addresses, fraud bureau data, and star ratings. The buying and selling consumers can have multiple risk scores for each transaction, such as a fraud, credit, return / chargeback, dissatisfaction, product misuse, nonreturnable, and defect risk scores. The buying and selling consumers can trade their risk levels before proceeding with the transaction.

Owner:VISA INT SERVICE ASSOC

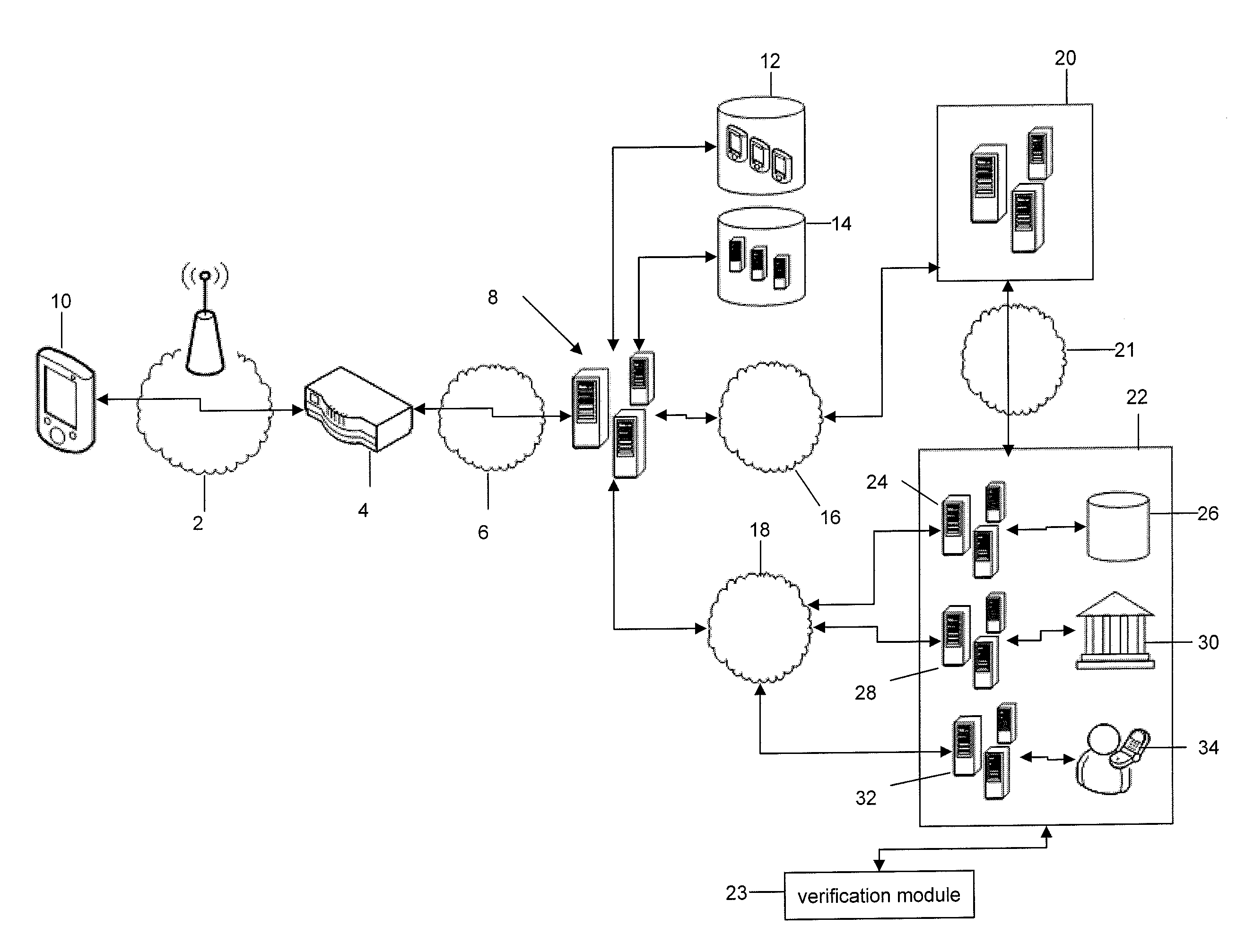

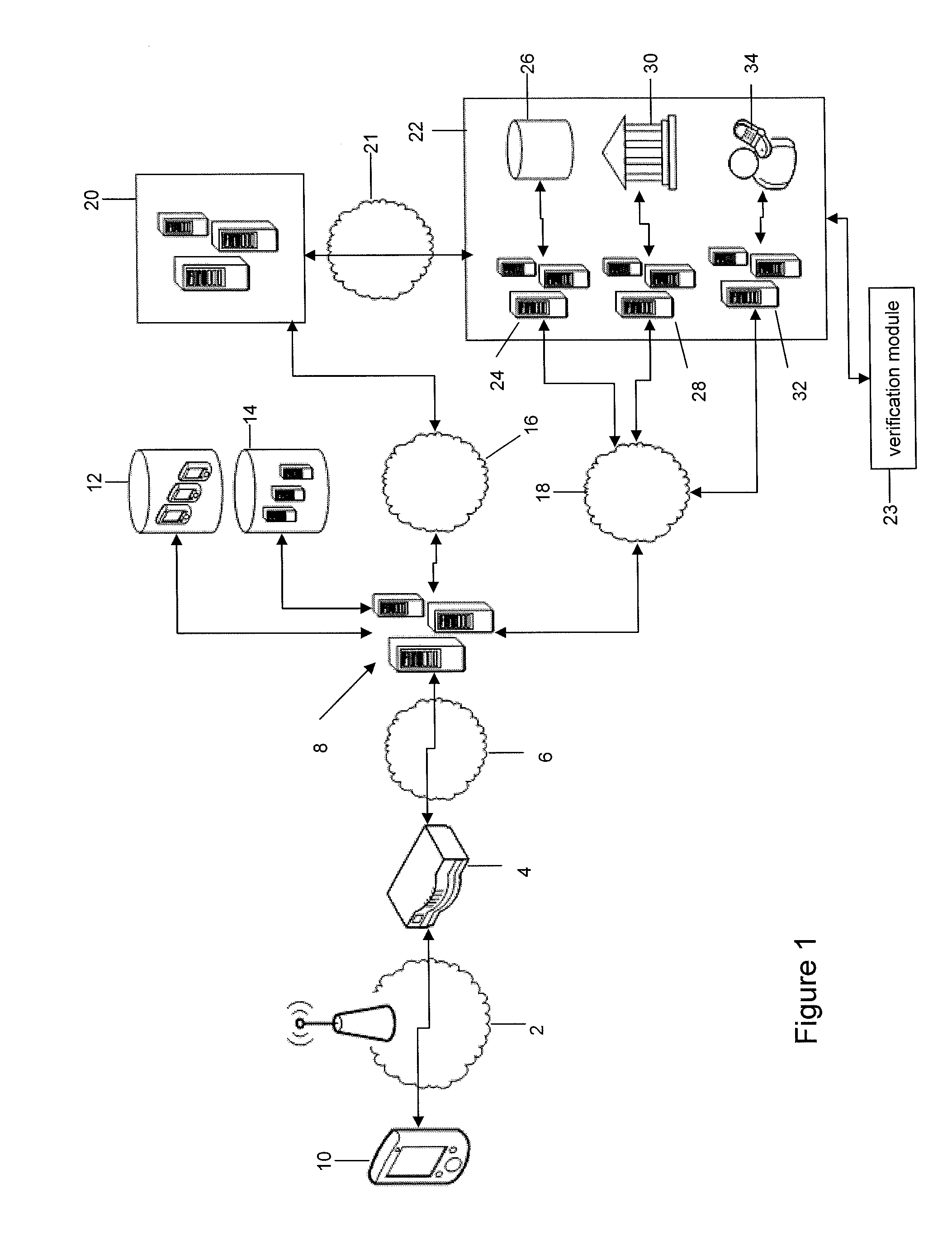

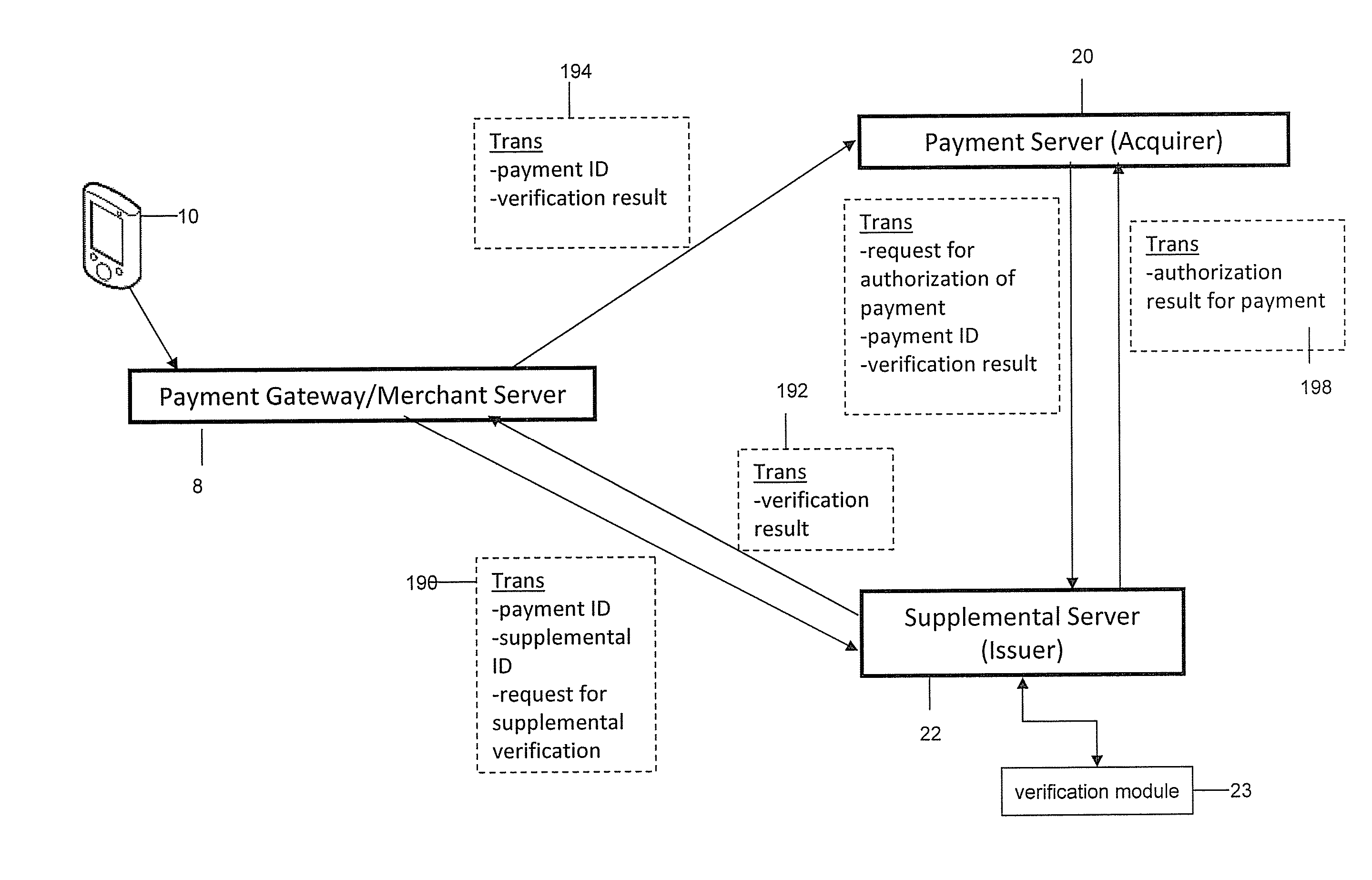

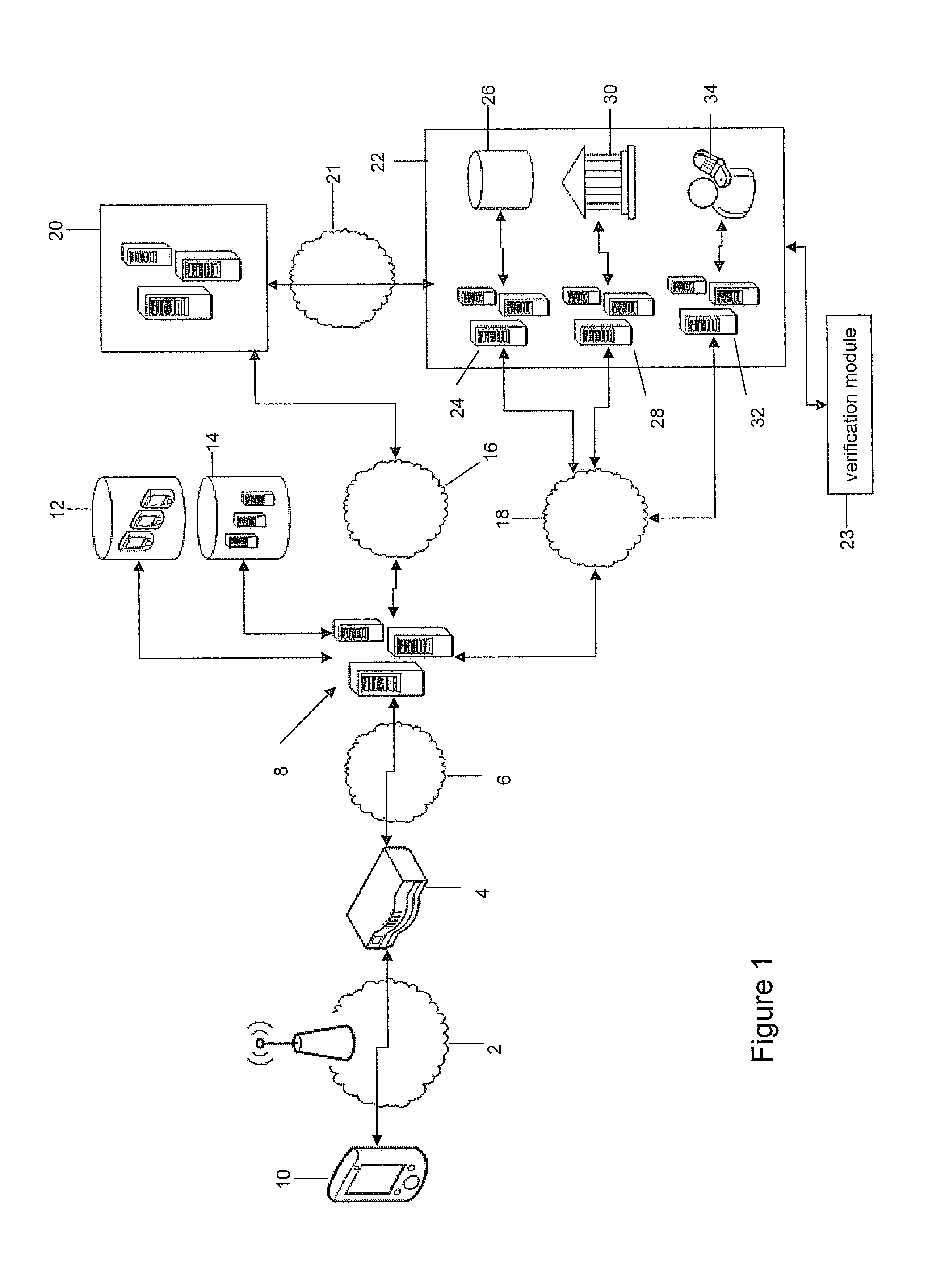

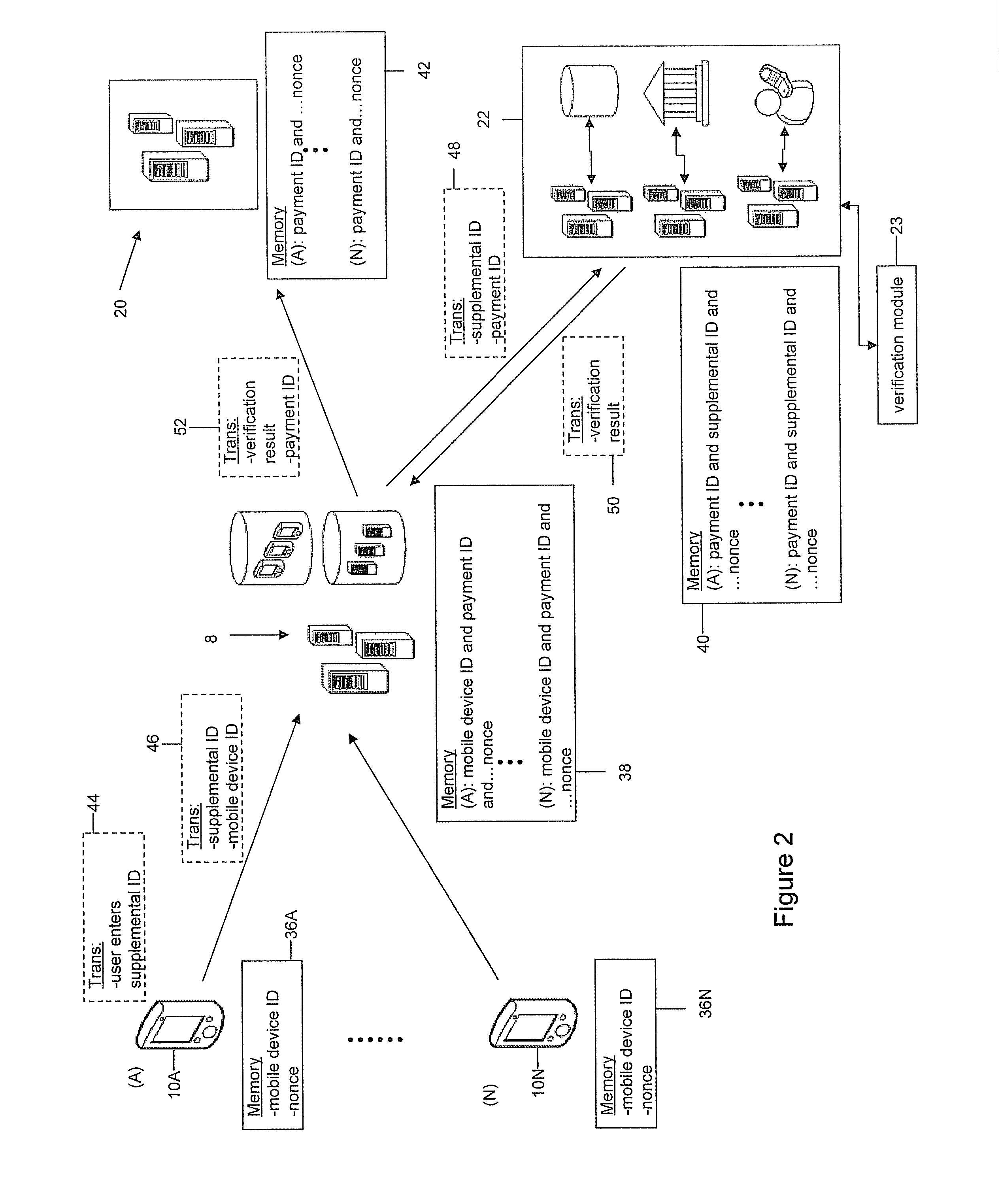

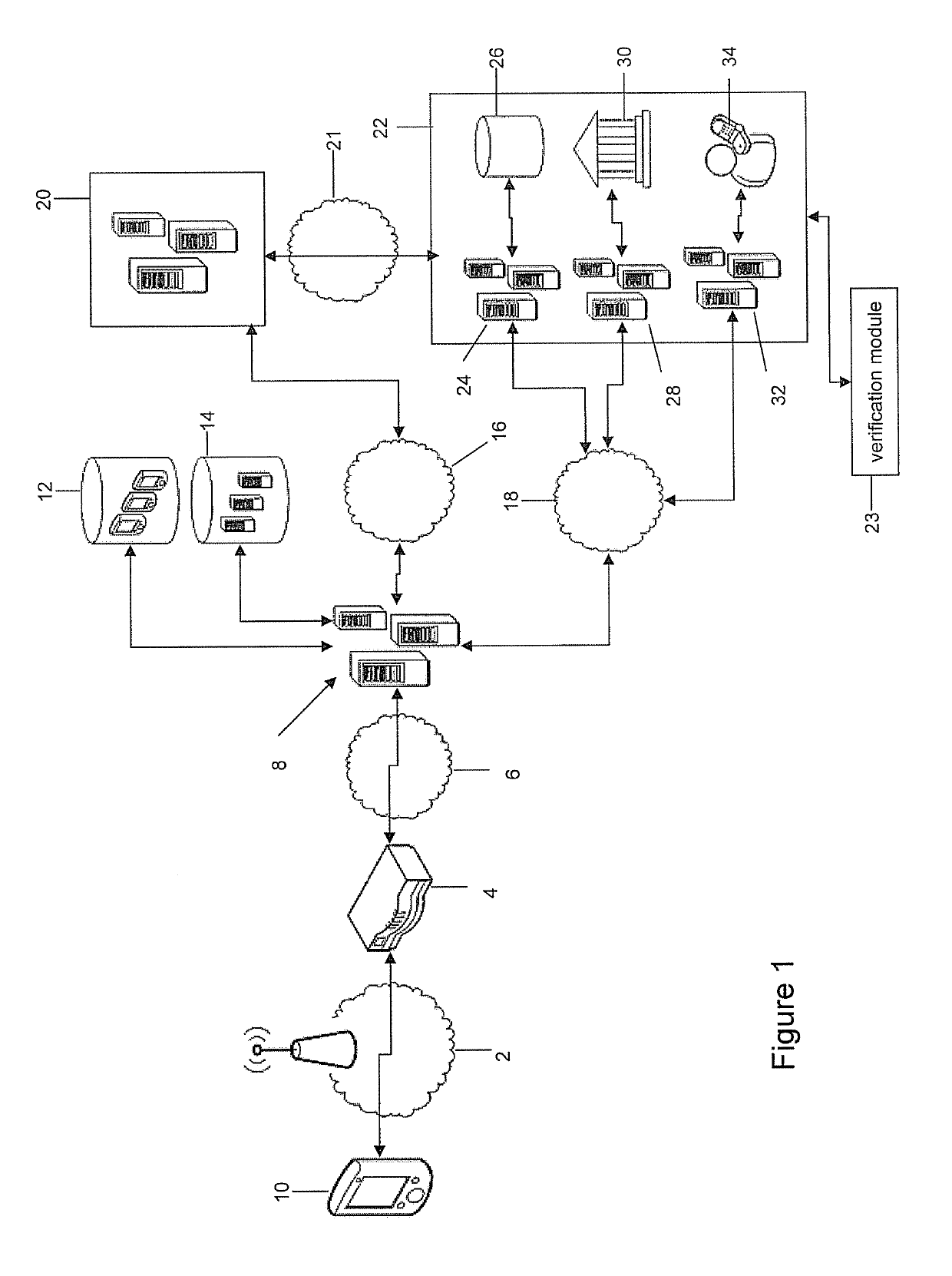

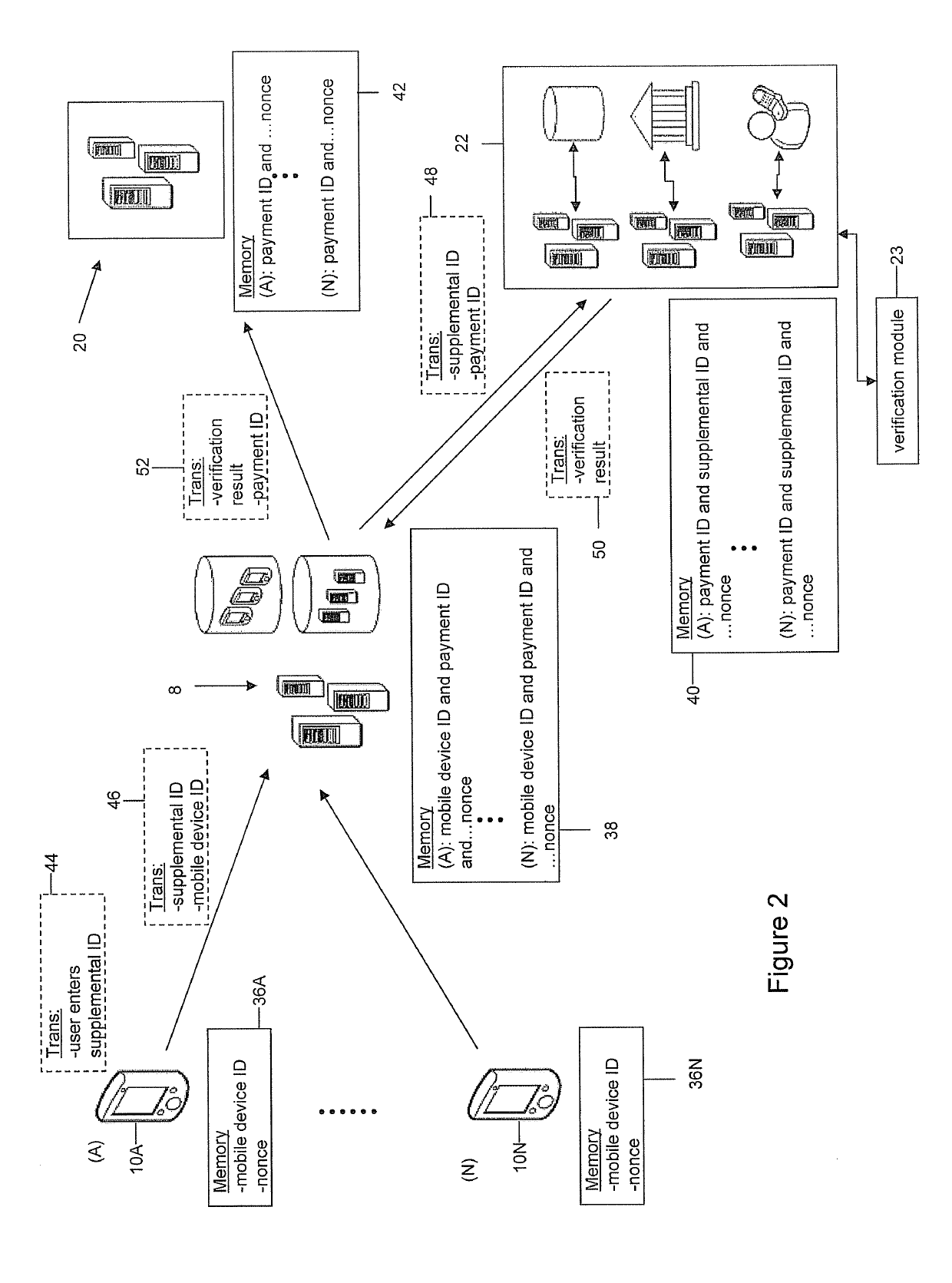

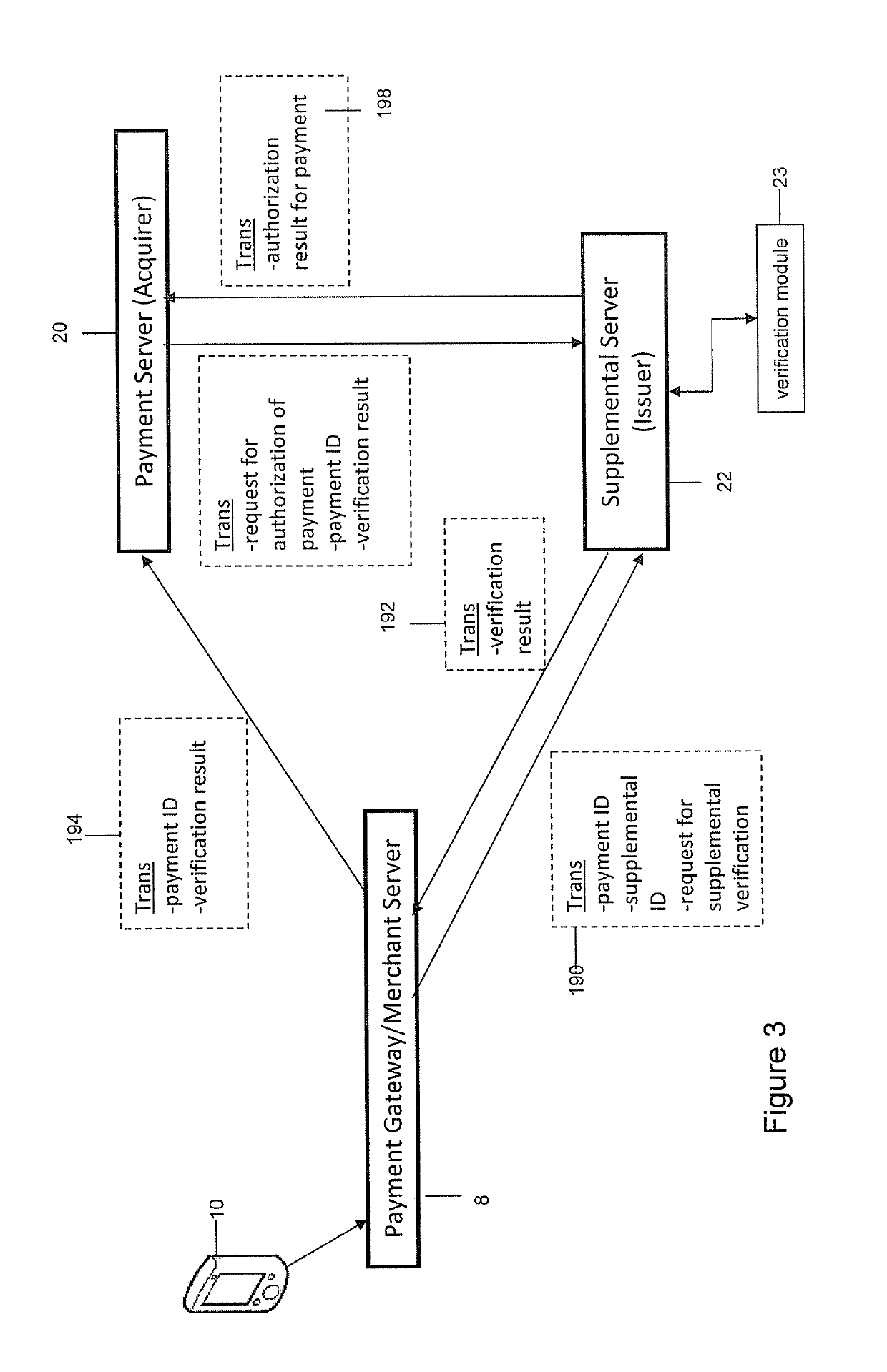

System and Method for Authenticating Transactions Through a Mobile Device

A user may claim to have not made or allowed a transaction and that the transaction was made in error. Where it appears the user has not authorized the transaction, the funds of the transaction are returned to the user, or are charged back. Systems and methods provide a way to confirm whether or not a transaction was actually authorized by the user, thereby settling a chargeback dispute for a previously executed transaction. The method comprises receiving the dispute regarding the transaction including associated transaction data, and retrieving a digital signature associated with the transaction data, the digital signature computed by signing the transaction data. The digital signature is then verified using a public key, wherein the public key corresponds to a private key stored on a mobile device. It is then determined whether or not the transaction is fraudulent based on a verification result of the digital signature.

Owner:SALT TECH

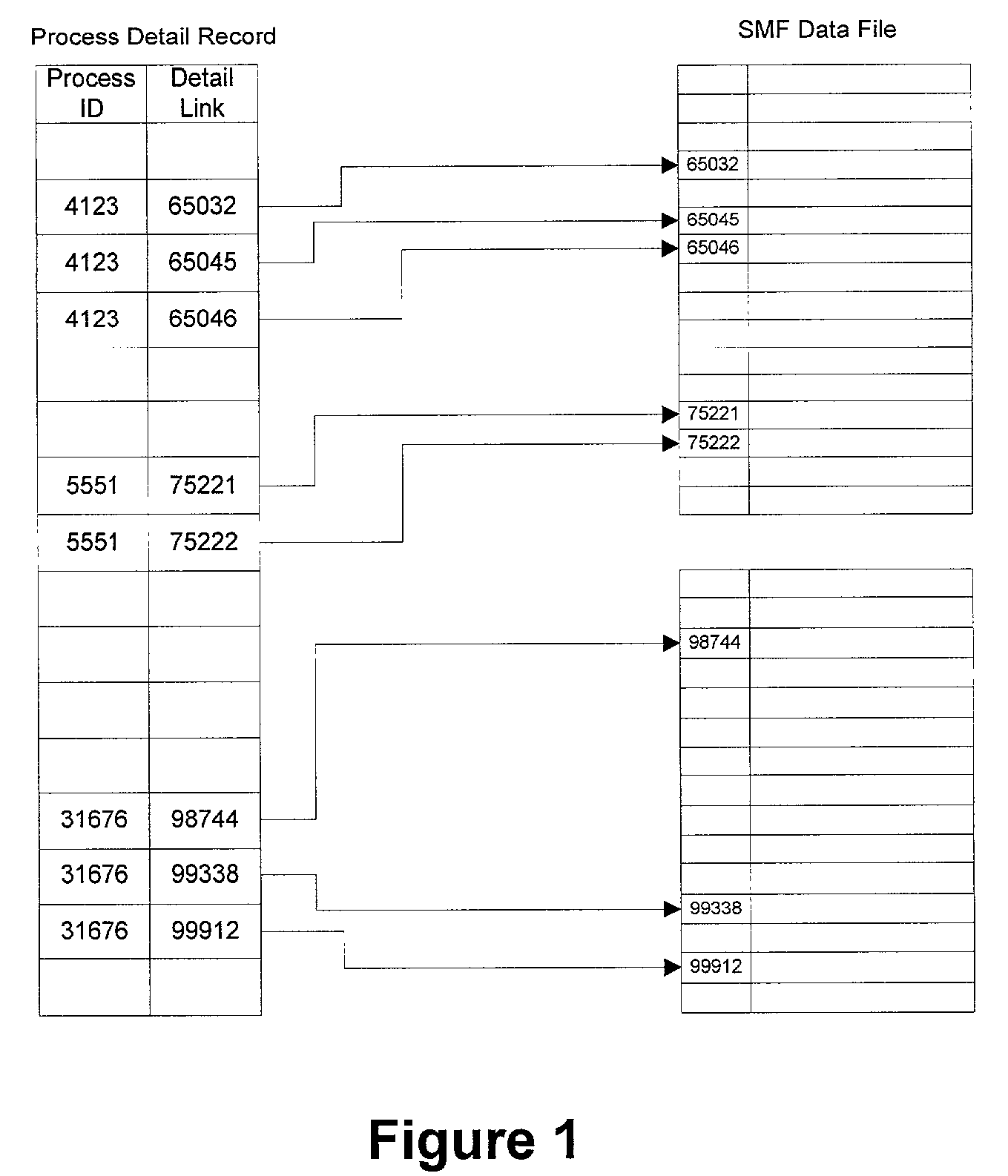

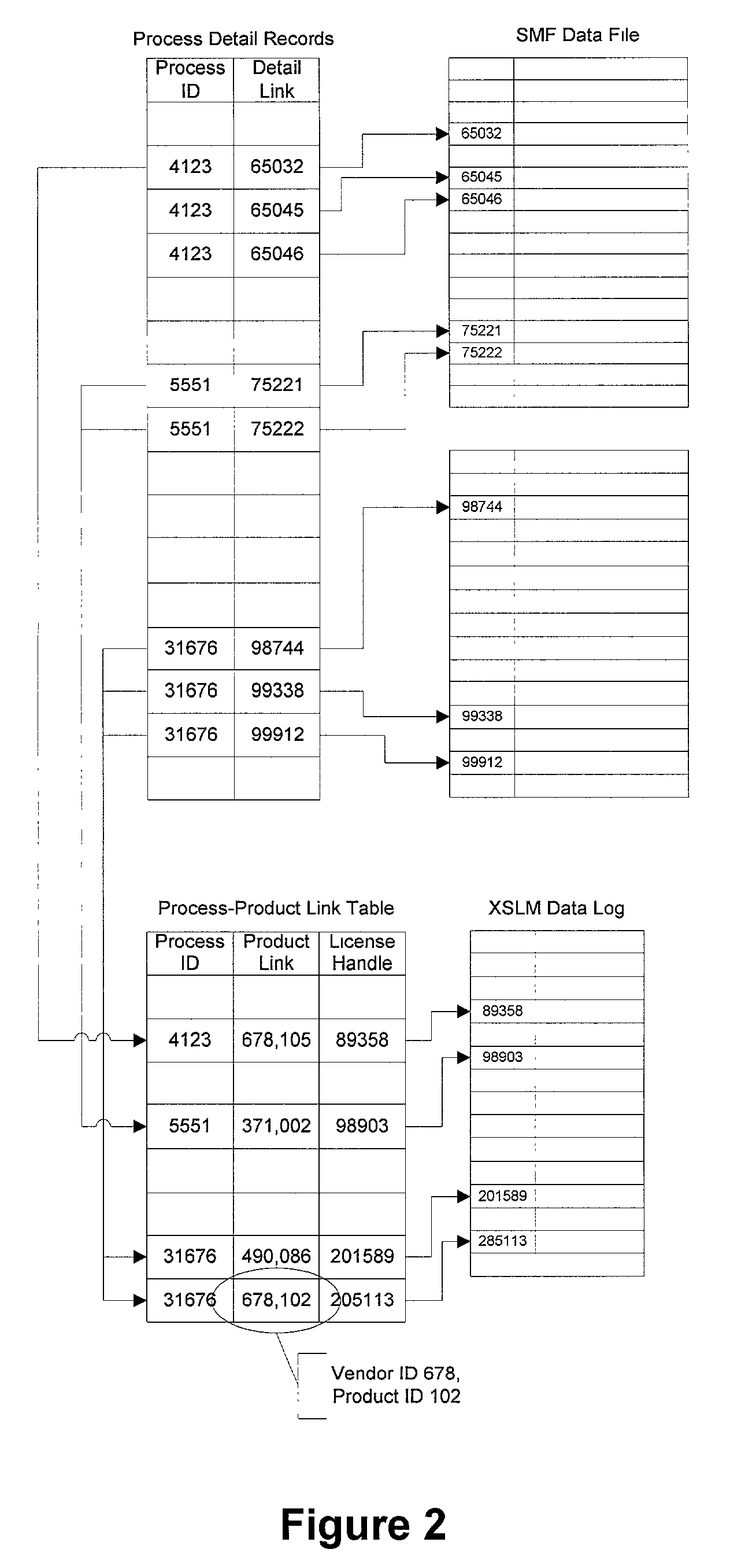

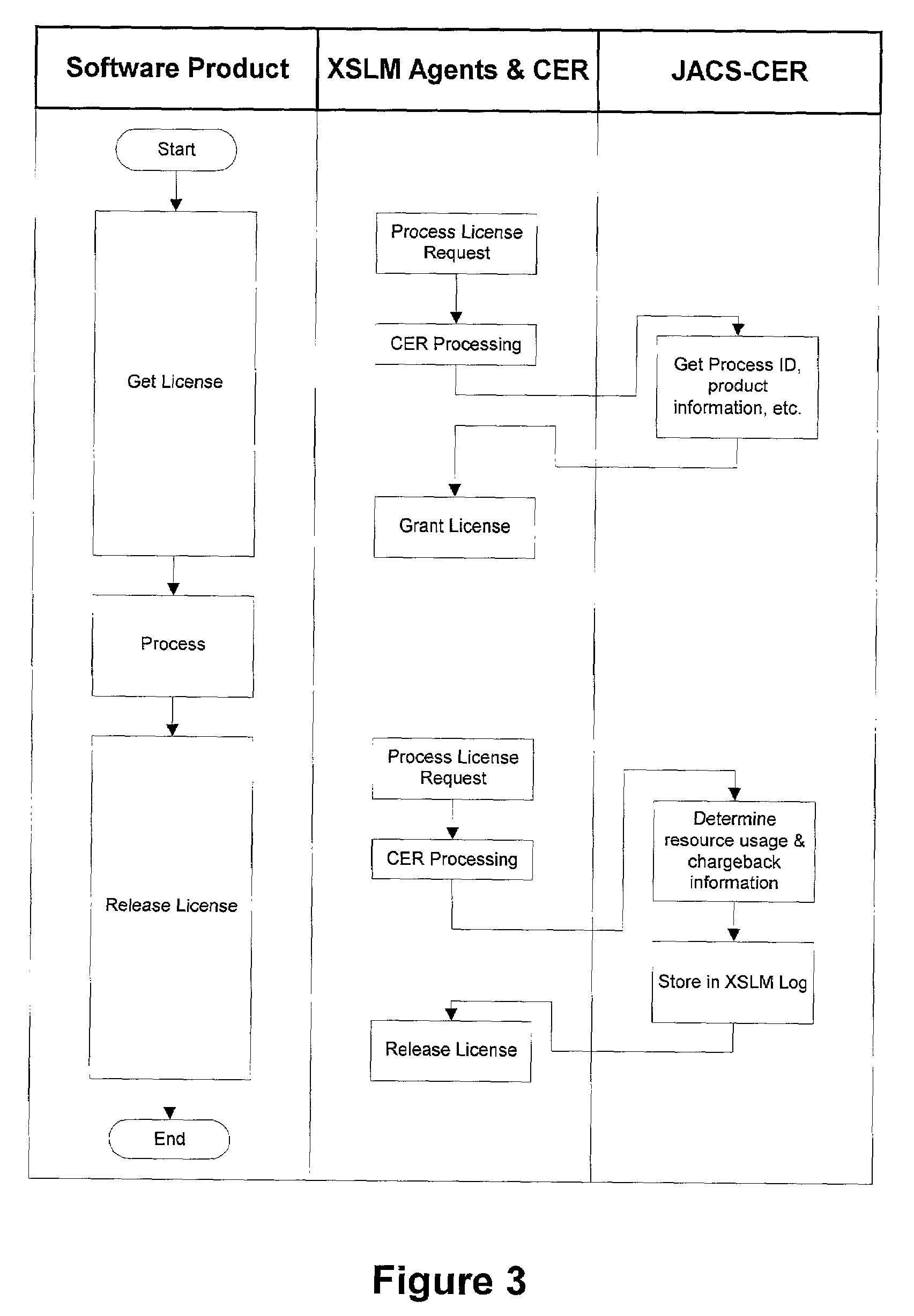

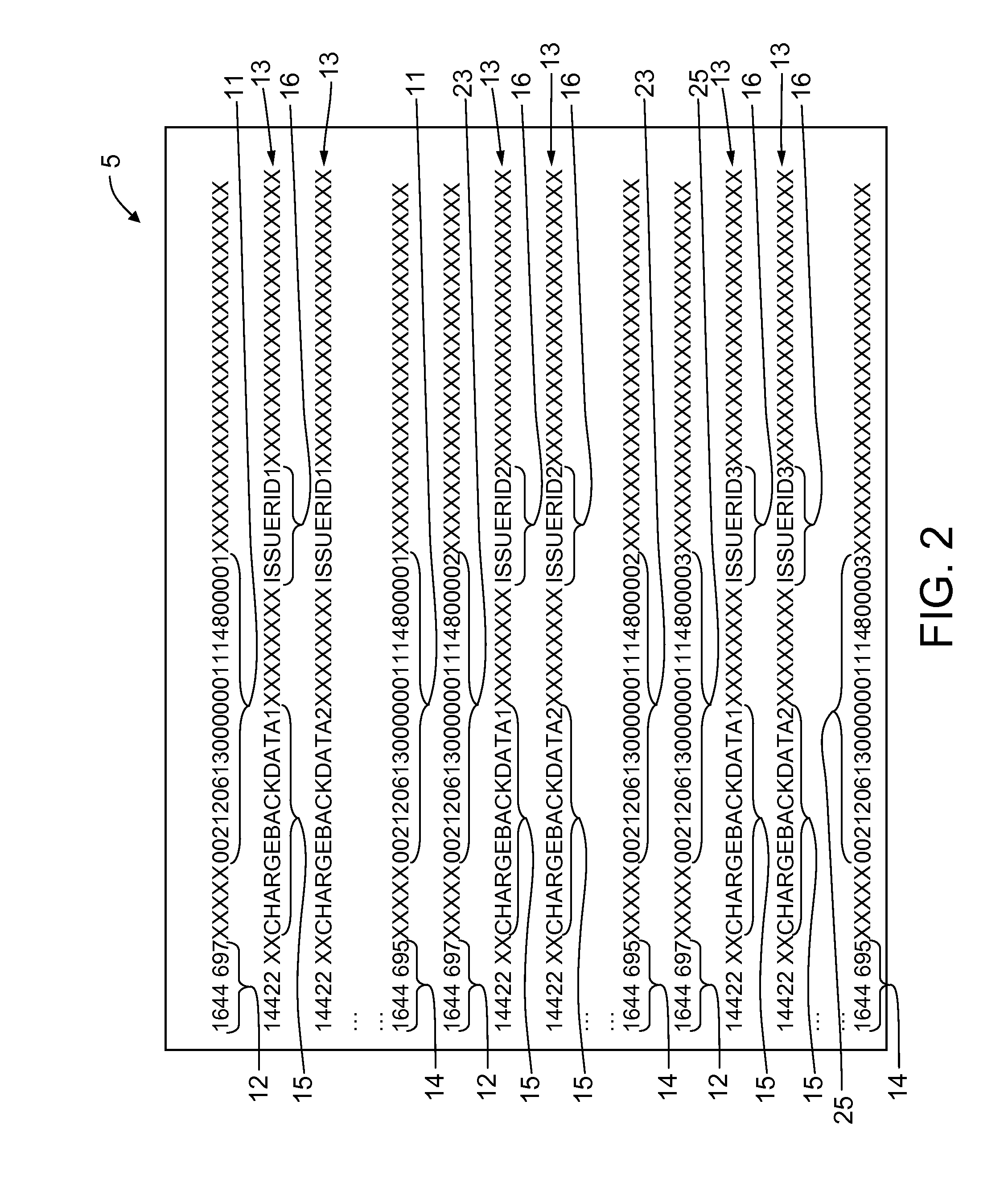

Method and system for correlating job accounting information with software license information

A job accounting and chargeback system for software products is comprised of a software license manager in the form of a software product use monitoring subsystem that handles requests for and grants rights to use software products, in such a manner that chargeback data is developed, which is then referenced to entities that are charged for the use of the software products. To better correlate the chargeback data with the use of software products, the chargeback data is referenced to the actual amount and type of use of software products being used, rather than on the use of computer facilities.

Owner:IBM CORP

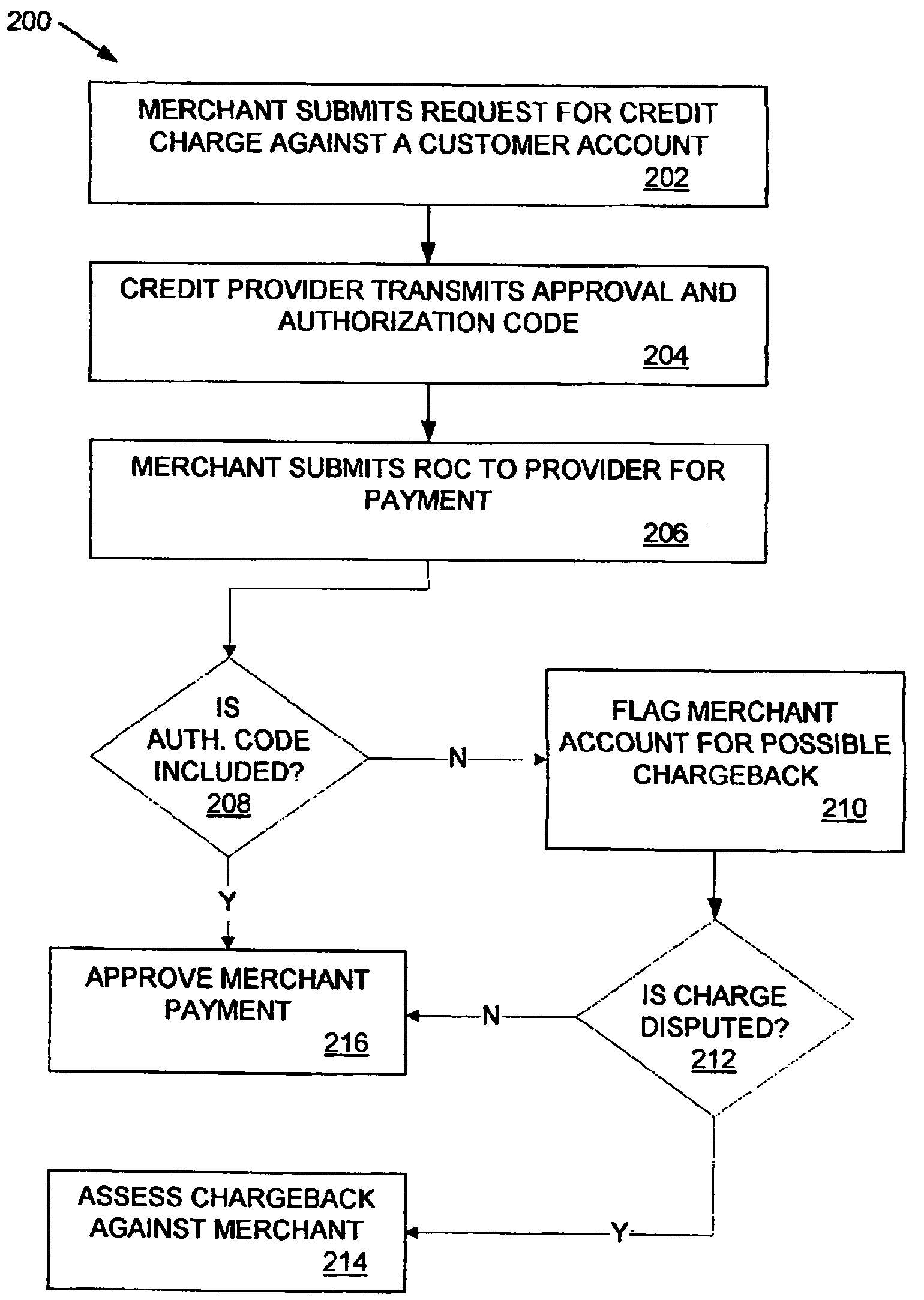

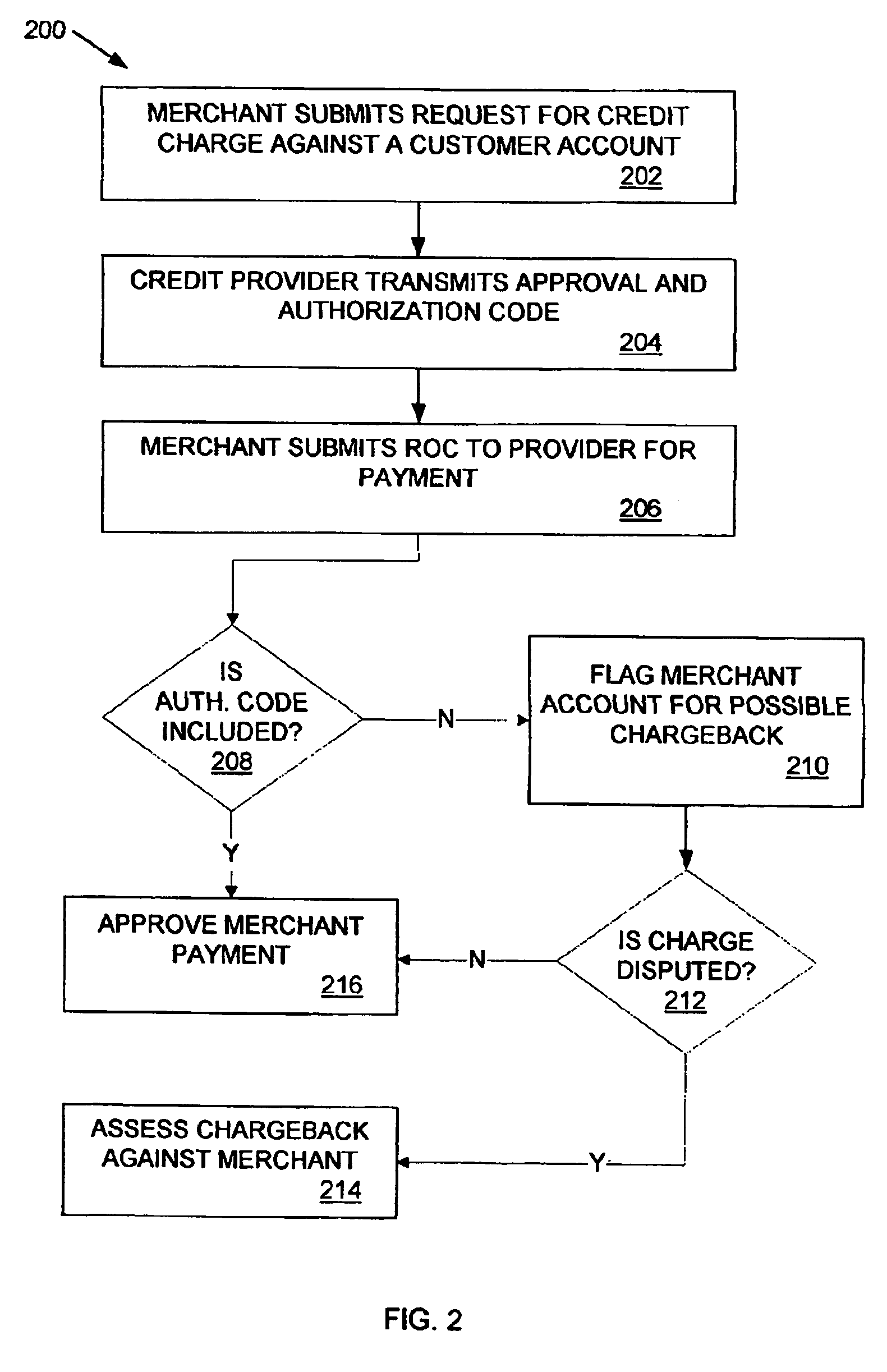

Method and apparatus for reducing fraudulent credit transactions by requiring merchant return of multi-digit authorization codes

Processes for reducing fraudulent credit transactions, including financial (e.g., credit, charge, debit, etc.) card transactions, are introduced, in which merchants receive multi-digit authorization codes from a credit provider (e.g., a customer transaction account card user) with all approved transactions. To guarantee payment, all merchants are required to later resubmit the multi-digit authorization code with every record of charge, regardless of dollar amount, as verification that an authorization was obtained. Merchants that fail to provide any authorization code, or an incorrect authorization code, will be subject to a chargeback for non-compliance.

Owner:LIBERTY PEAK VENTURES LLC

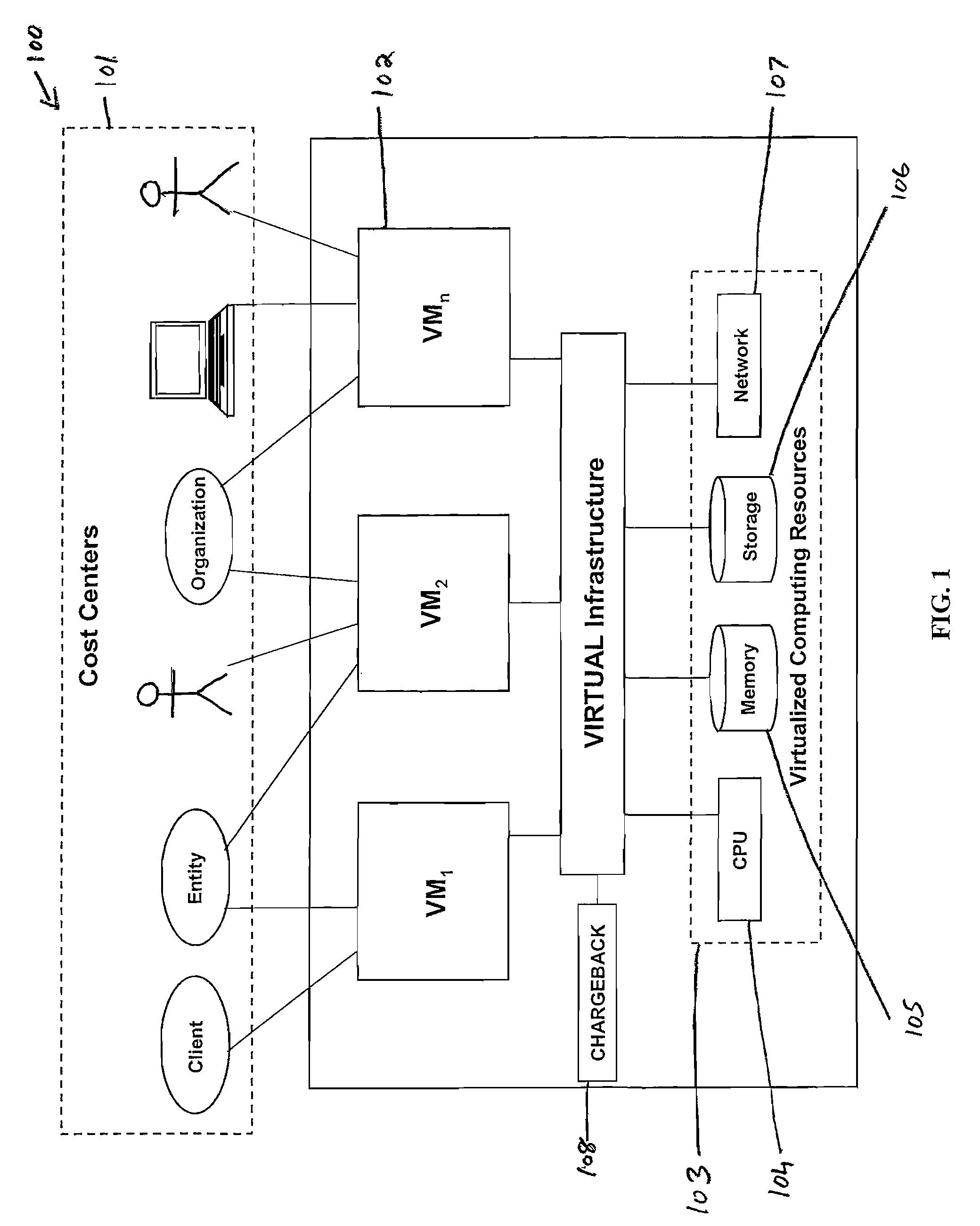

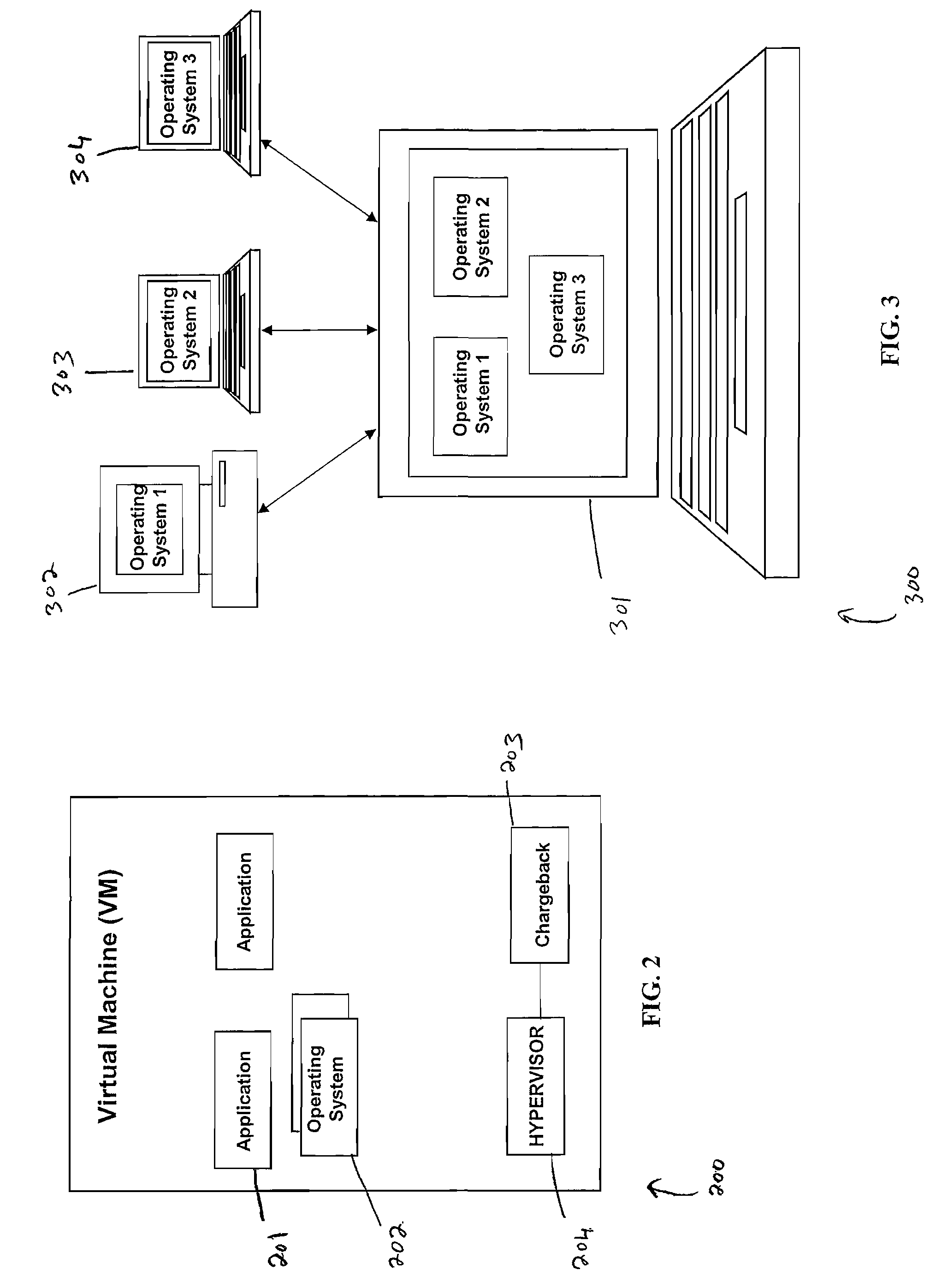

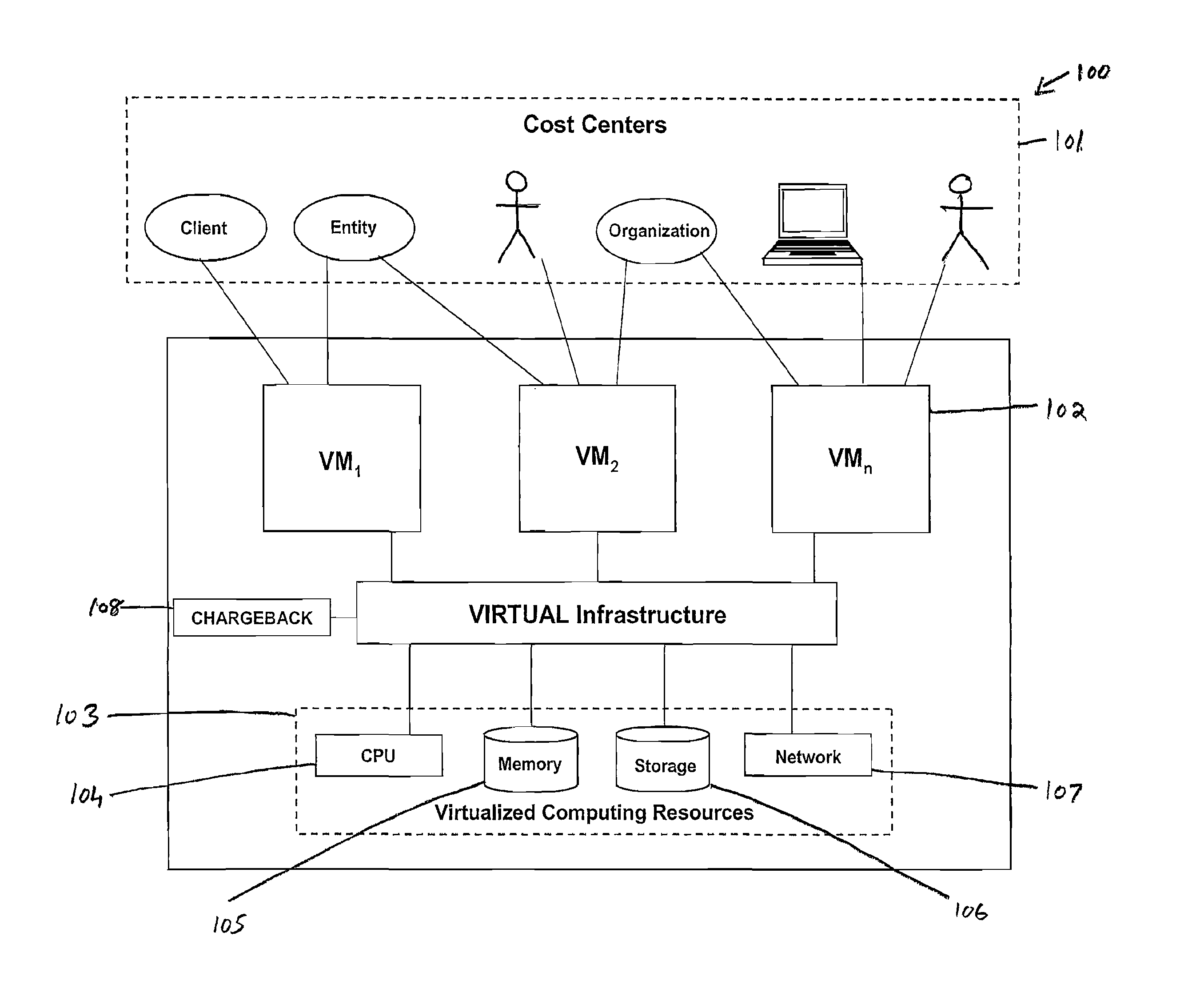

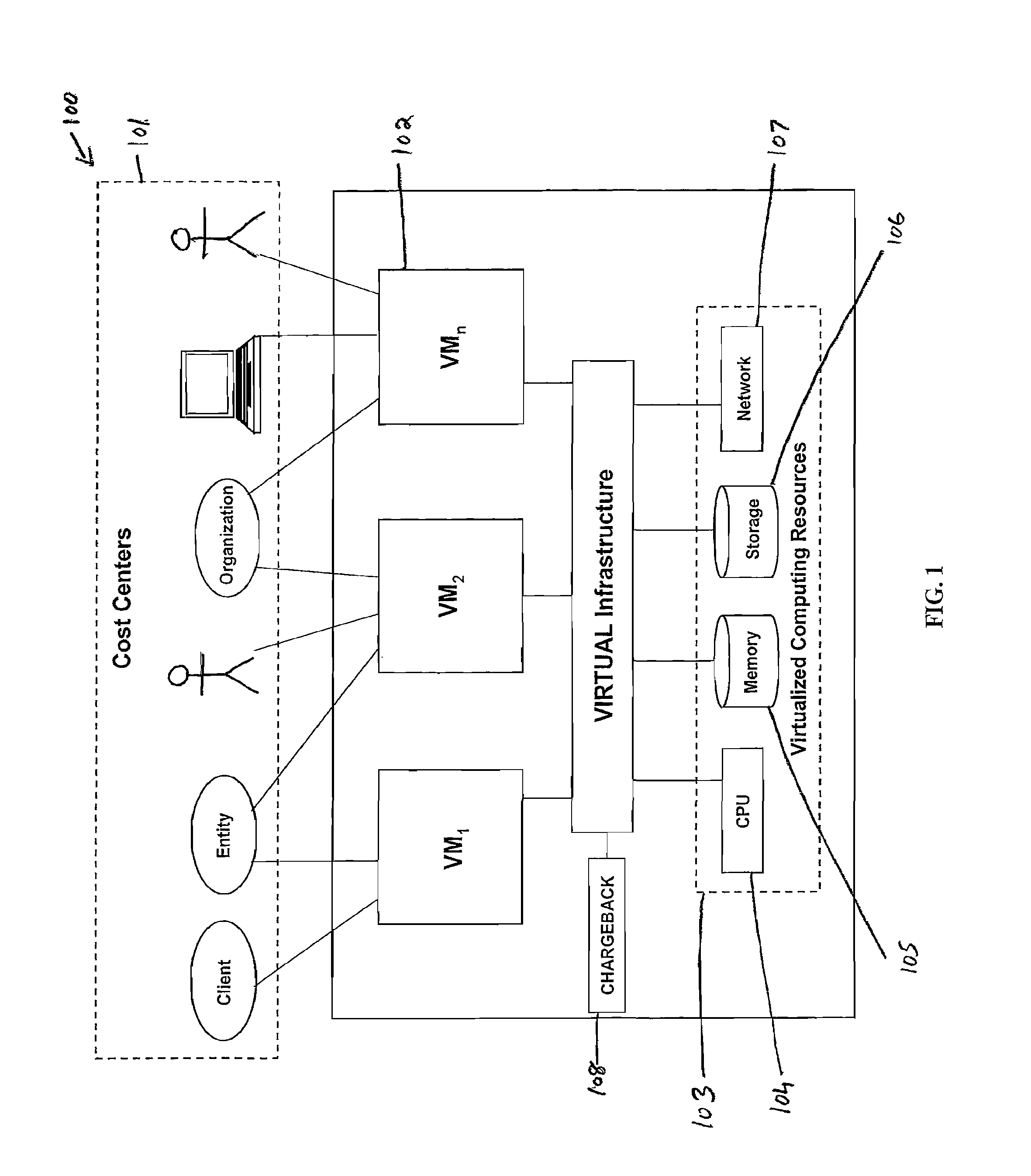

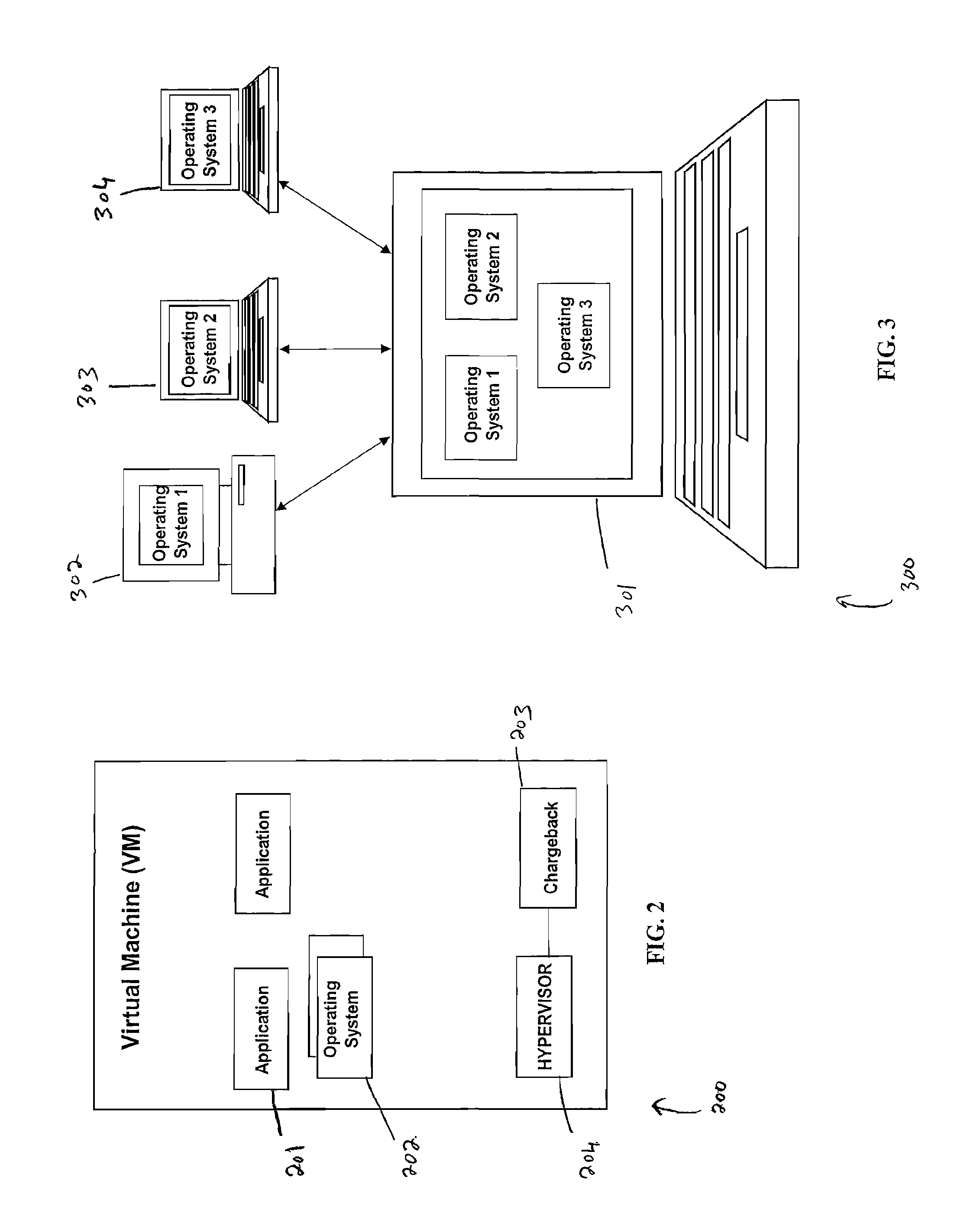

Method, system and apparatus for calculating chargeback for virtualized computing resources

InactiveUS20090164356A1Accurate calculationAccurately reportComplete banking machinesTelephonic communicationVirtualizationCost recovery

Method, system and apparatus for calculating chargeback for virtualized computing resources in a virtualized environment allowing efficient use of computing resources, improving costs recovery including fixed and over-usage cost of utilizing computing resources.

Owner:QUEST SOFTWARE INC

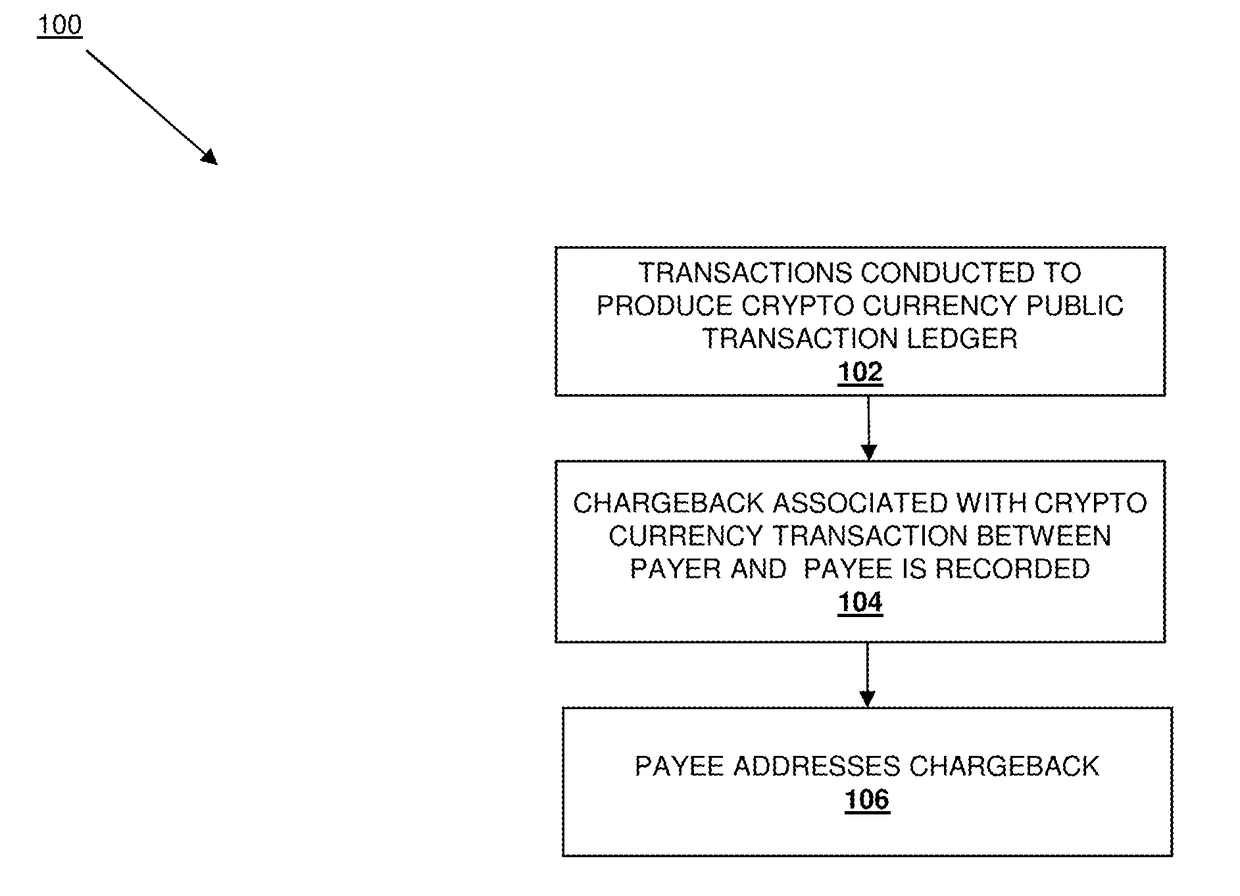

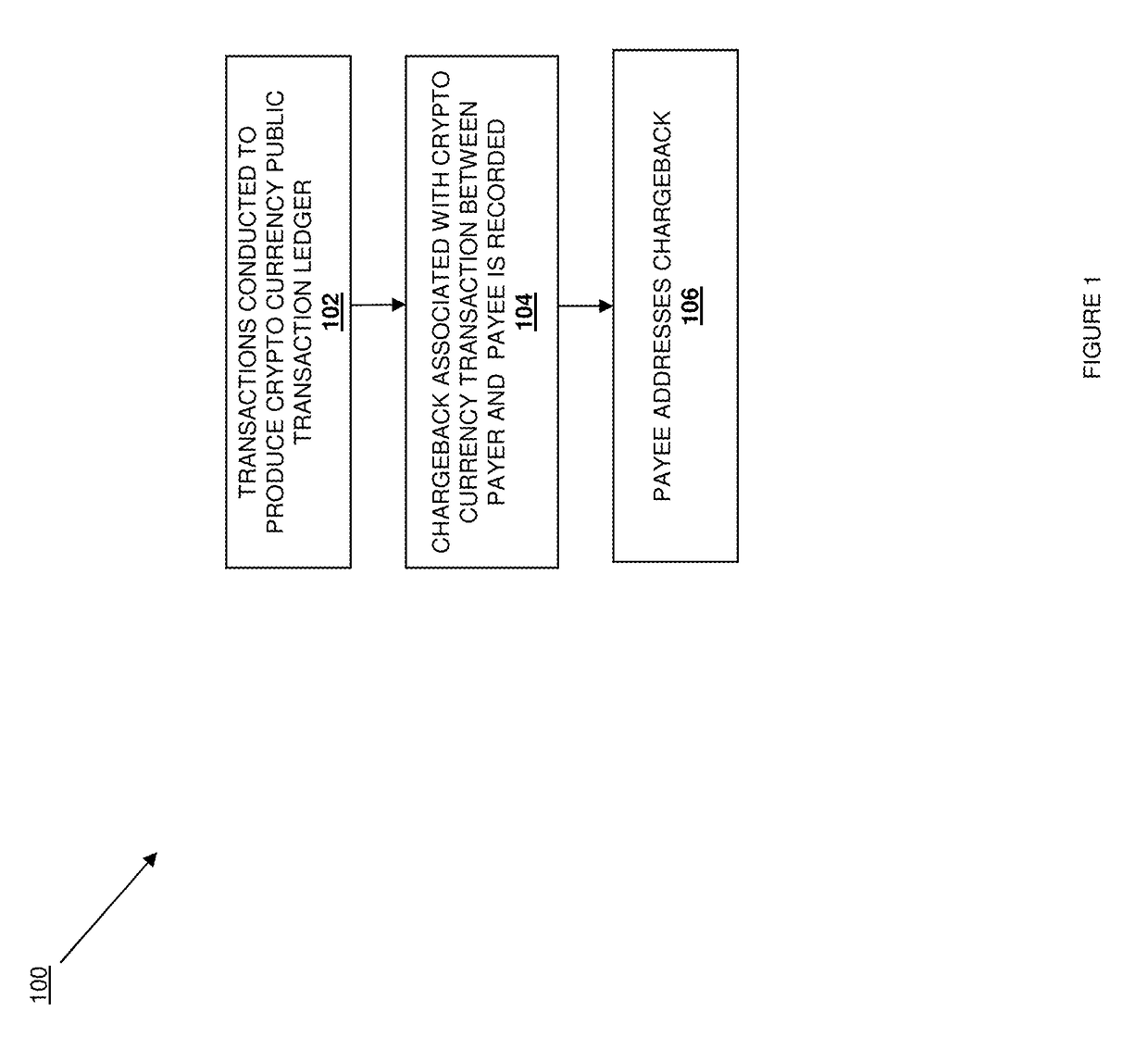

Crypto currency chargeback system

Distributed crypto currency chargeback systems and methods include at least one system provider device receiving, through a network from a payer device associated with a payer, a chargeback report associated with a first transaction of a plurality of transactions performed using a distributed crypto currency, where the first transaction involves the payer and a payee. The at least one system provider device publishes the chargeback report in a chargeback ledger. The at least one system provider device receives, through the network from a payee device associated with the payee subsequent to publishing the chargeback ledger including the chargeback report, a chargeback response associated with the first transaction. The at least one system provider device then publishes the chargeback response in the chargeback ledger.

Owner:PAYPAL INC

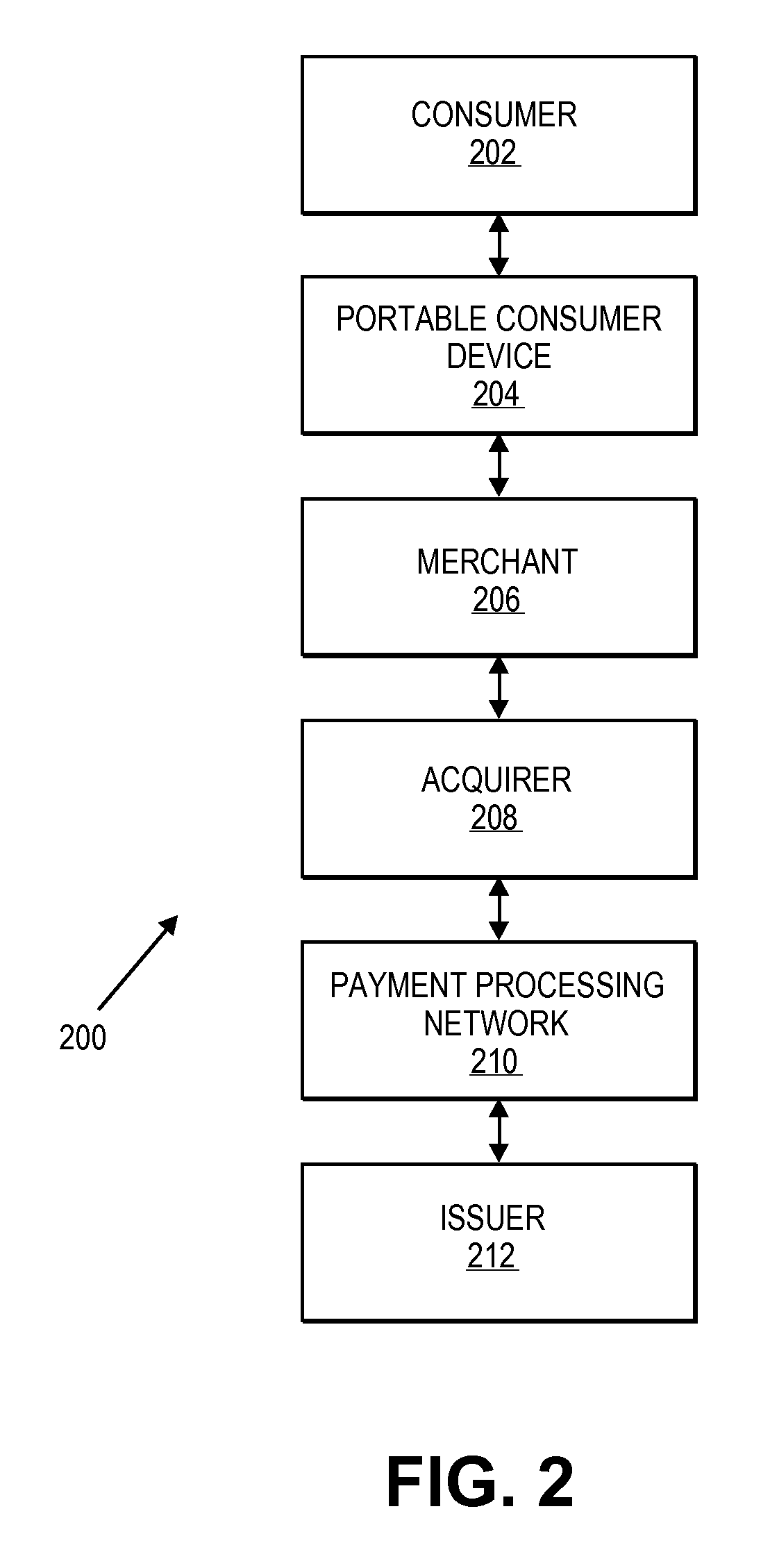

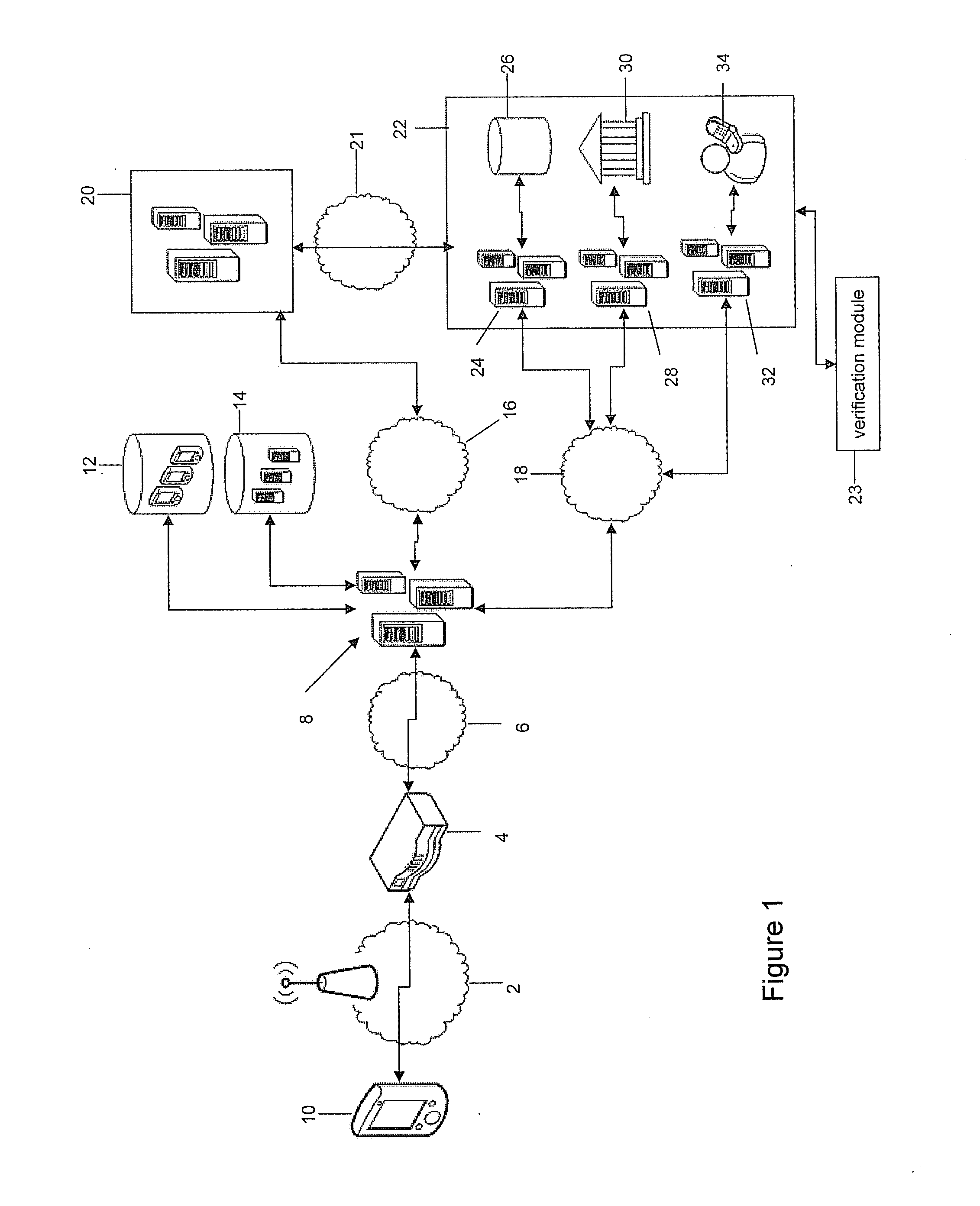

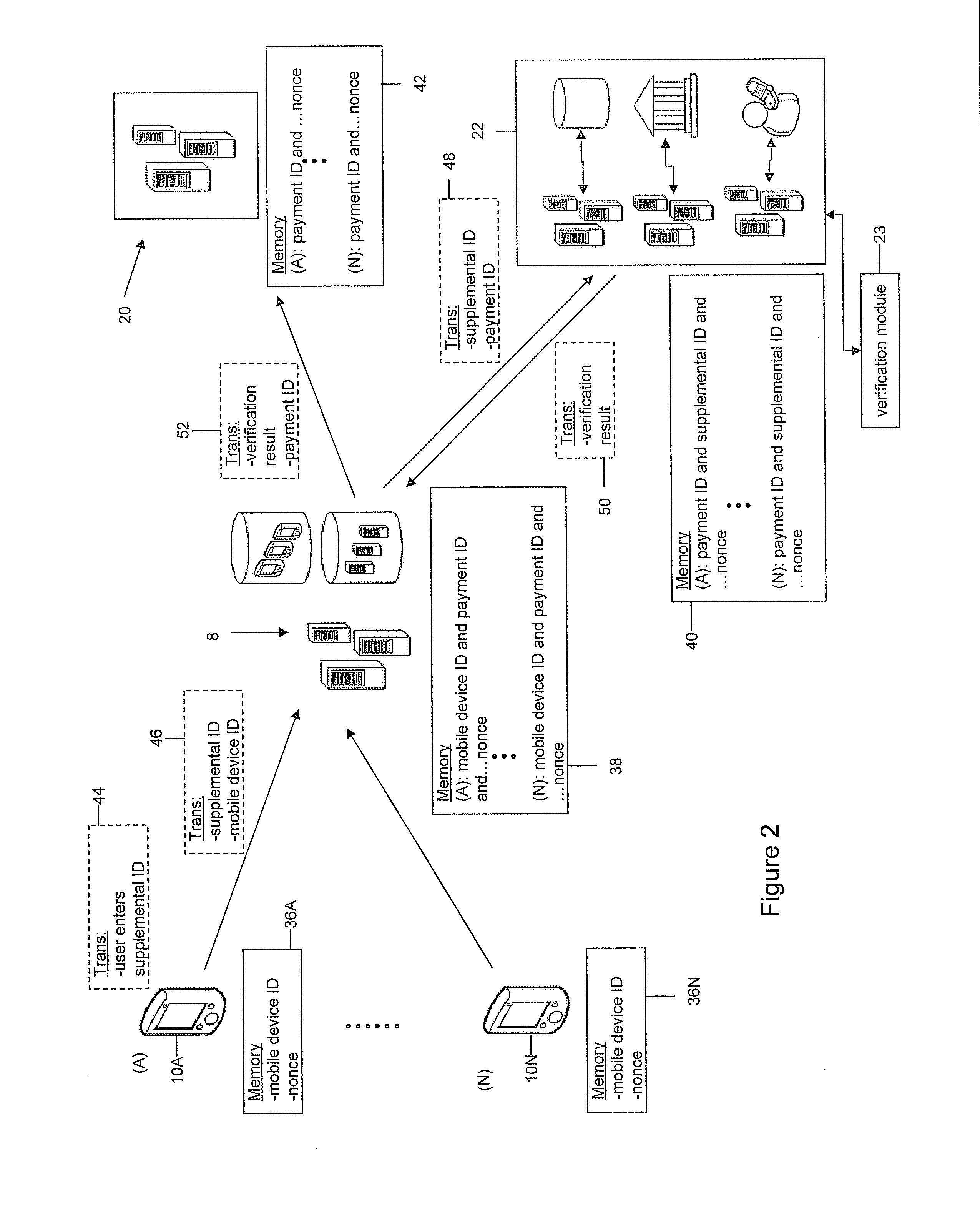

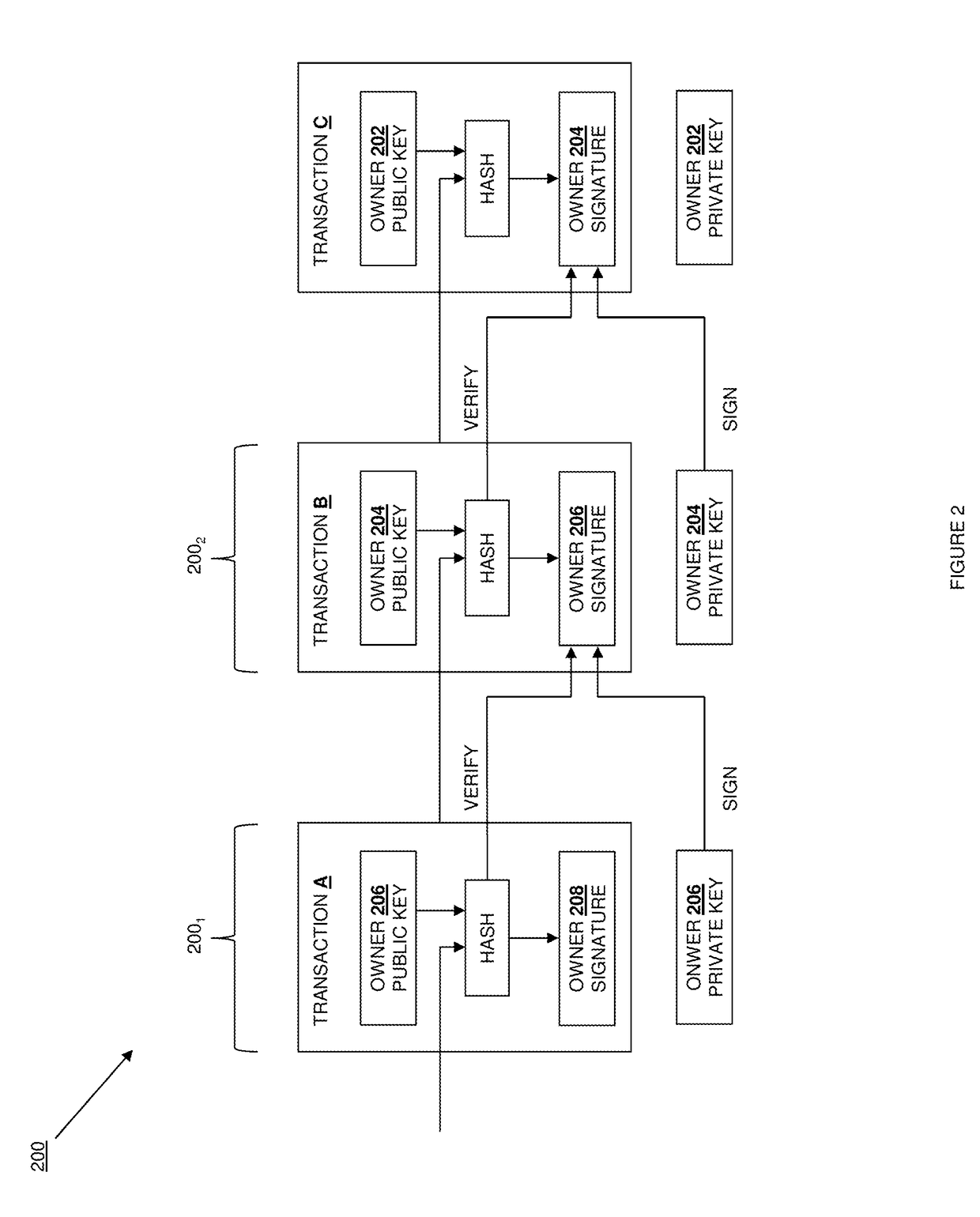

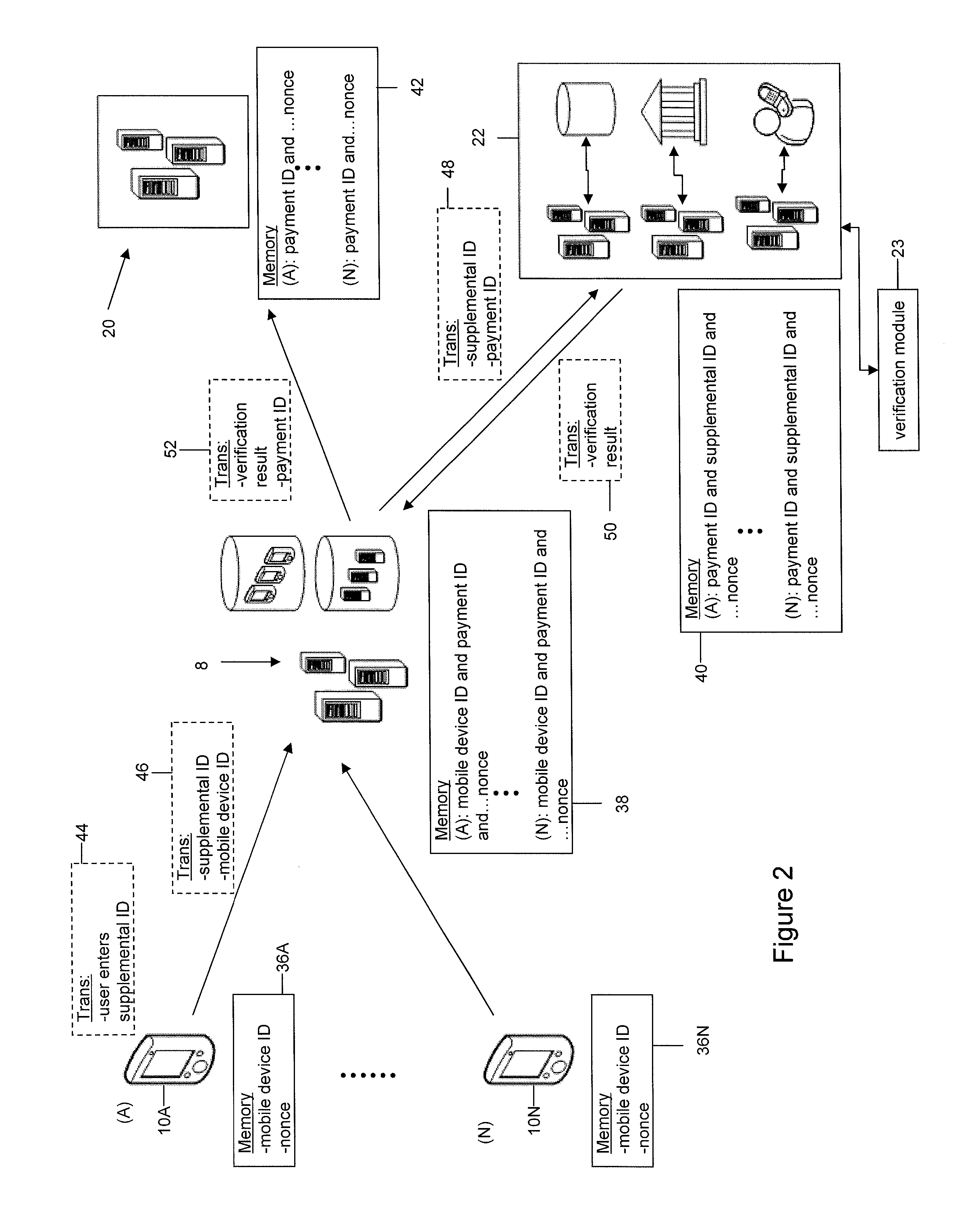

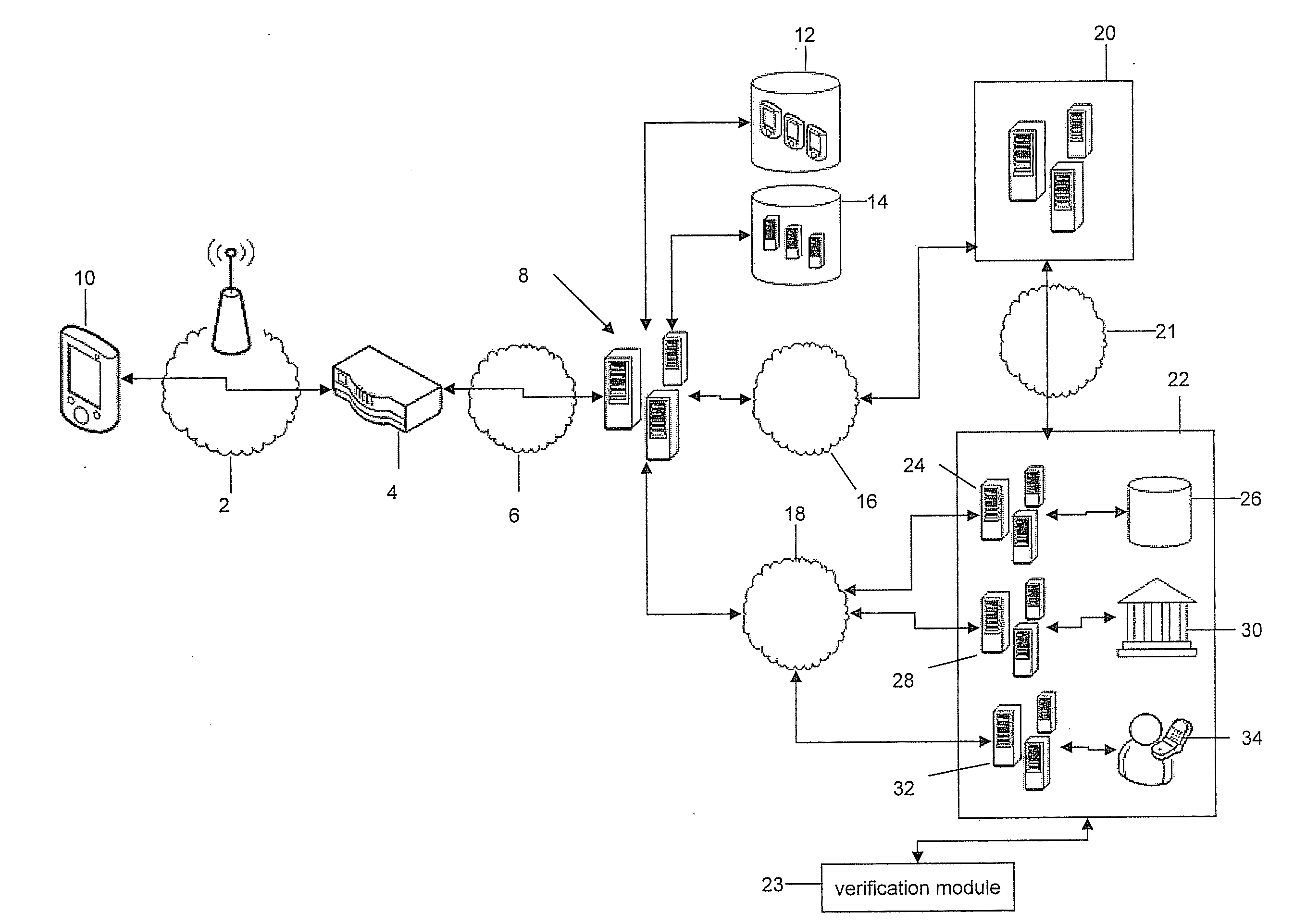

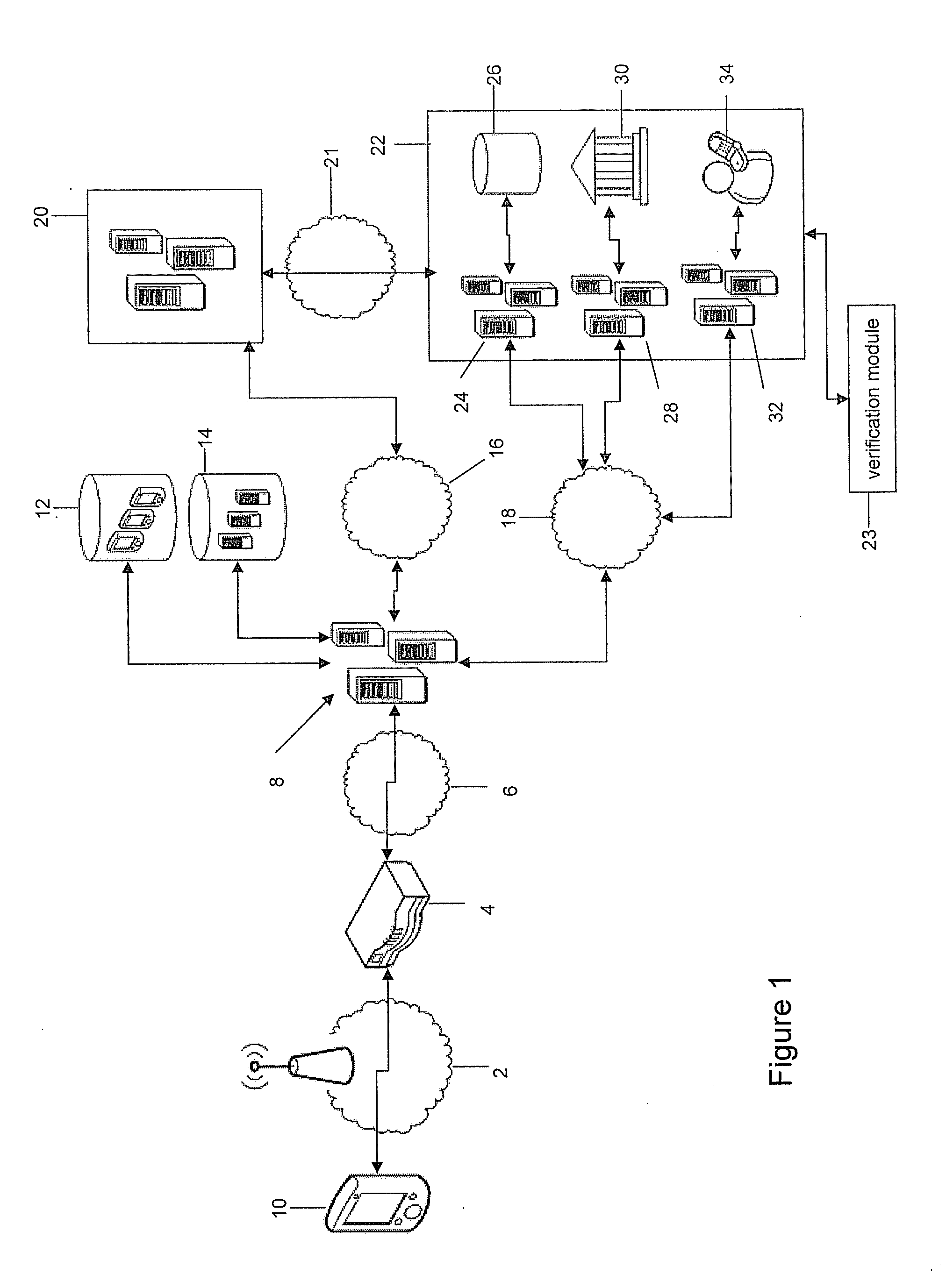

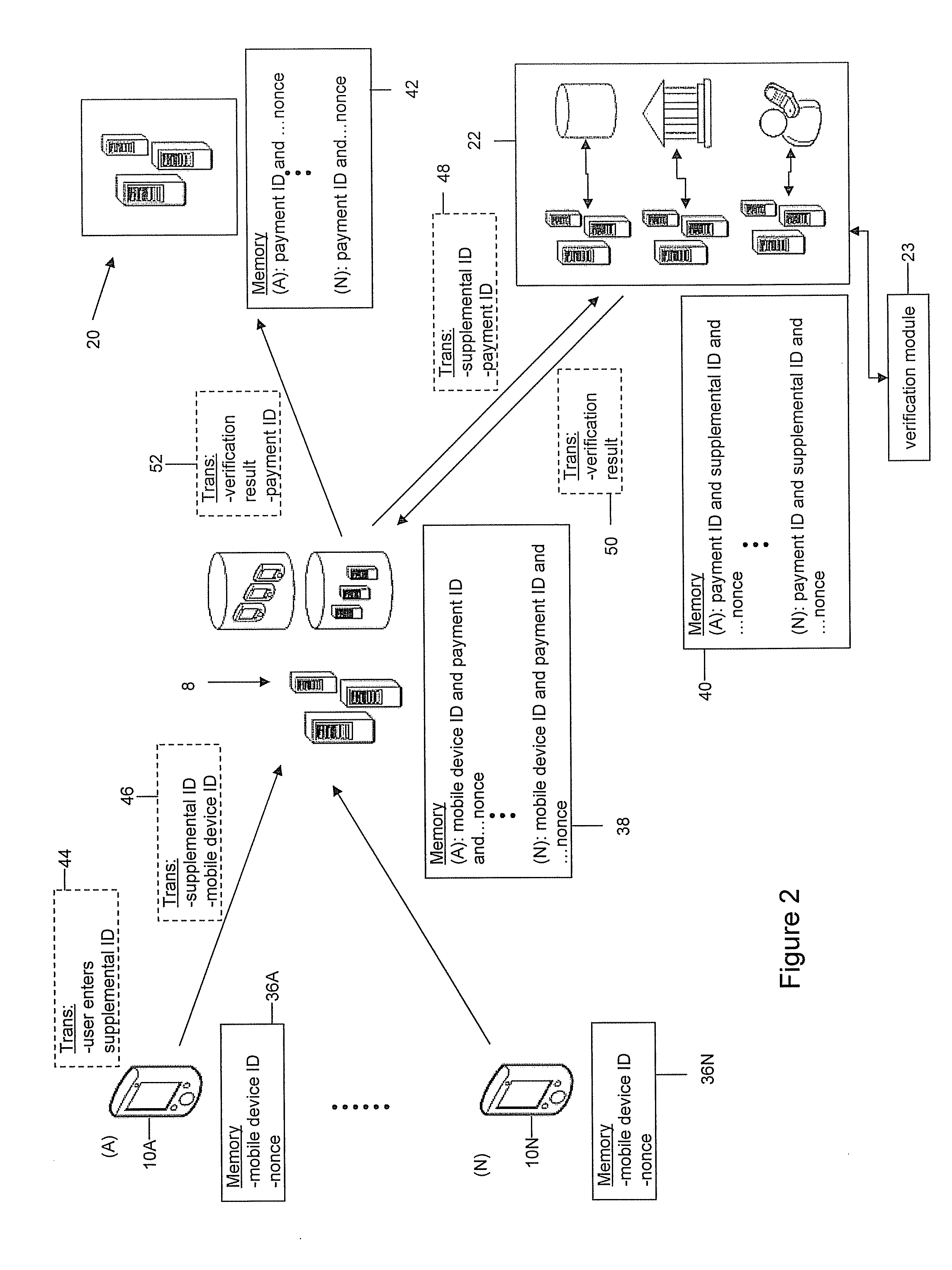

System and method for authenticating transactions through a mobile device

InactiveUS20120150748A1Network traffic/resource managementTelephonic communicationDigital signatureTransaction data

A user may claim to have not made or allowed a transaction and that the transaction was made in error. Where it appears the user has not authorized the transaction, the funds of the transaction are returned to the user, or are charged back. Systems and methods provide a way to confirm whether or not a transaction was actually authorized by the user, thereby settling a chargeback dispute for a previously executed transaction. The method comprises receiving the dispute regarding the transaction including associated transaction data, and retrieving a digital signature associated with the transaction data, the digital signature computed by signing the transaction data. The digital signature is then verified using a public key, wherein the public key corresponds to a private key stored on a mobile device. It is then determined whether or not the transaction is fraudulent based on a verification result of the digital signature.

Owner:SALT TECH

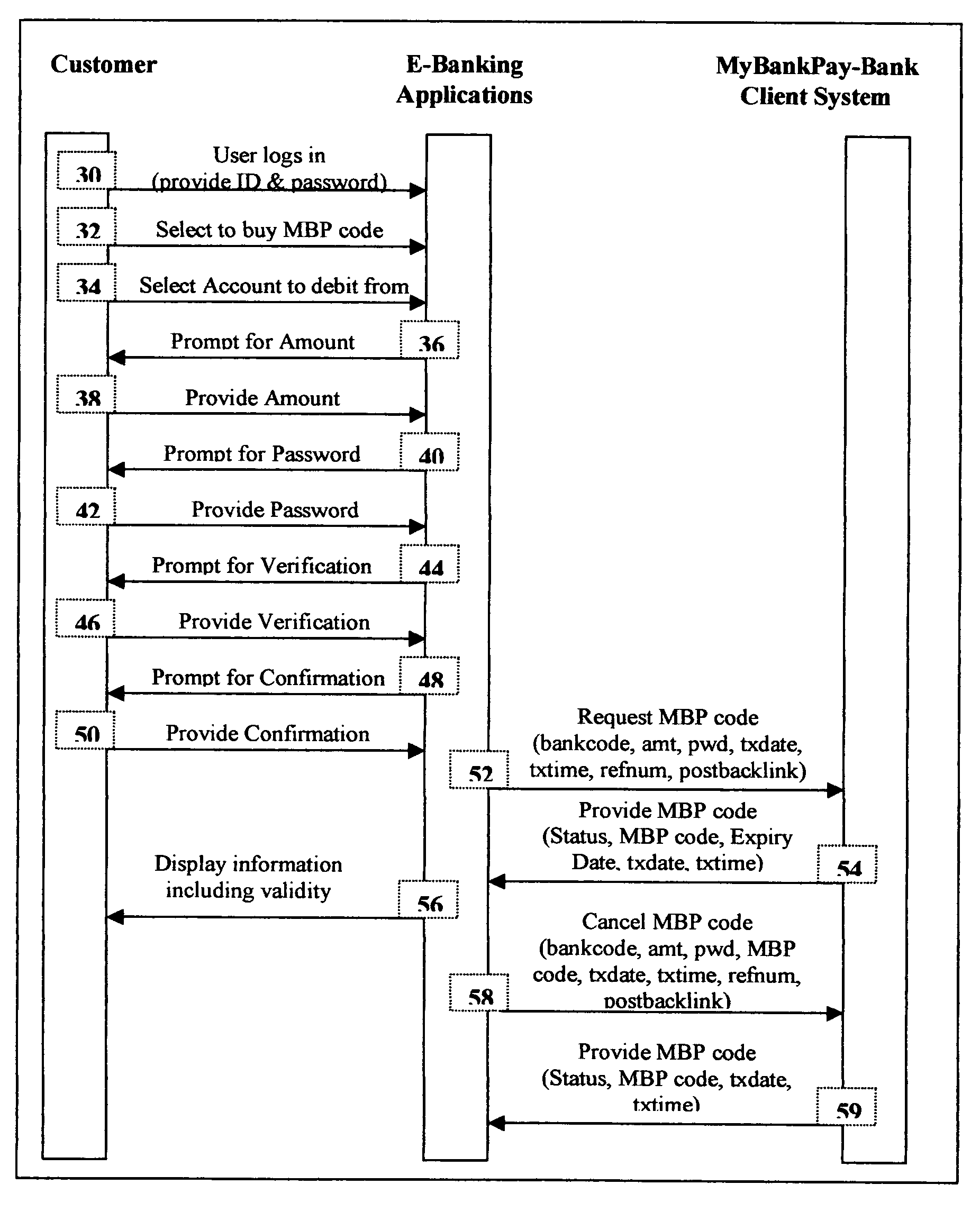

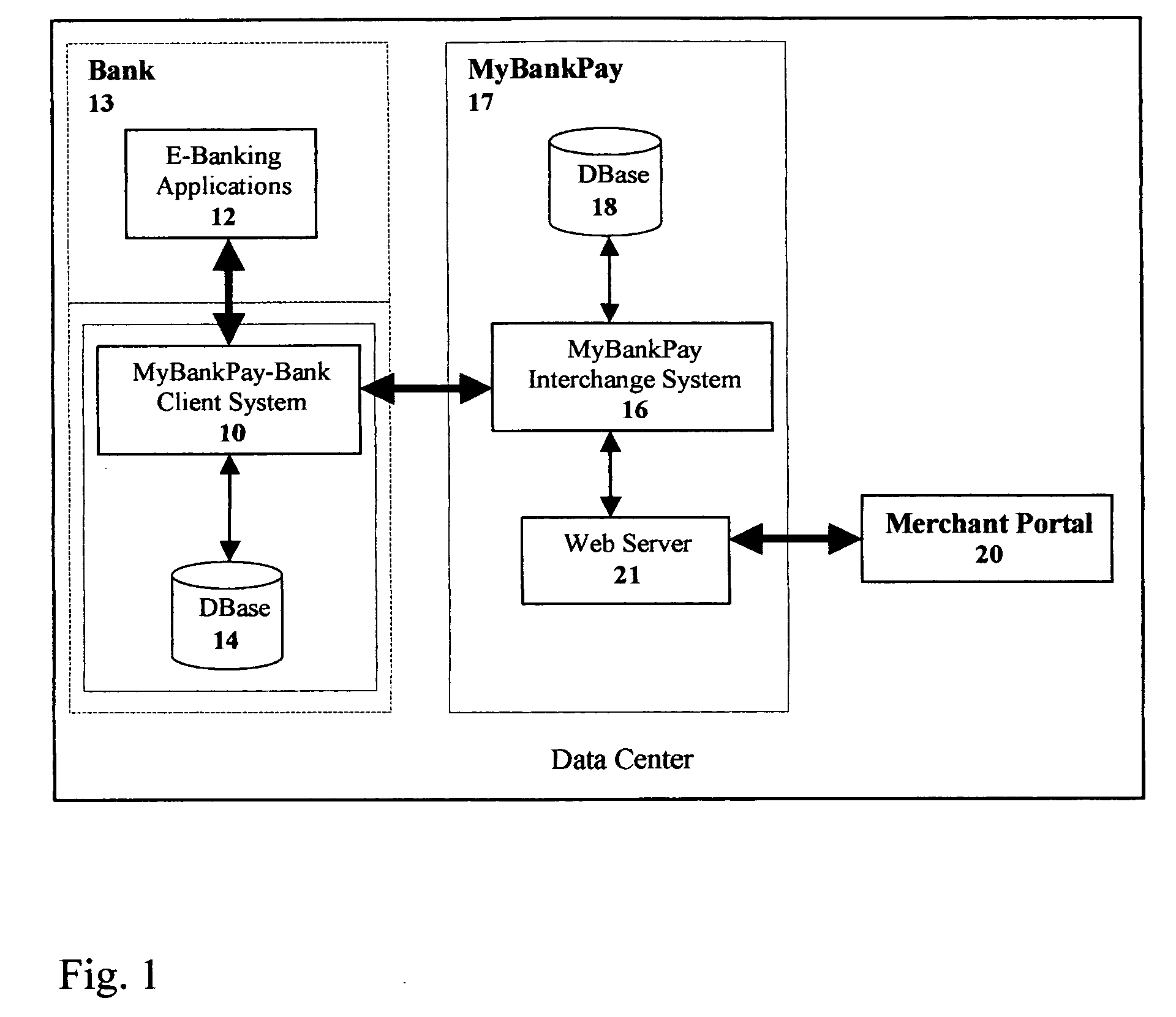

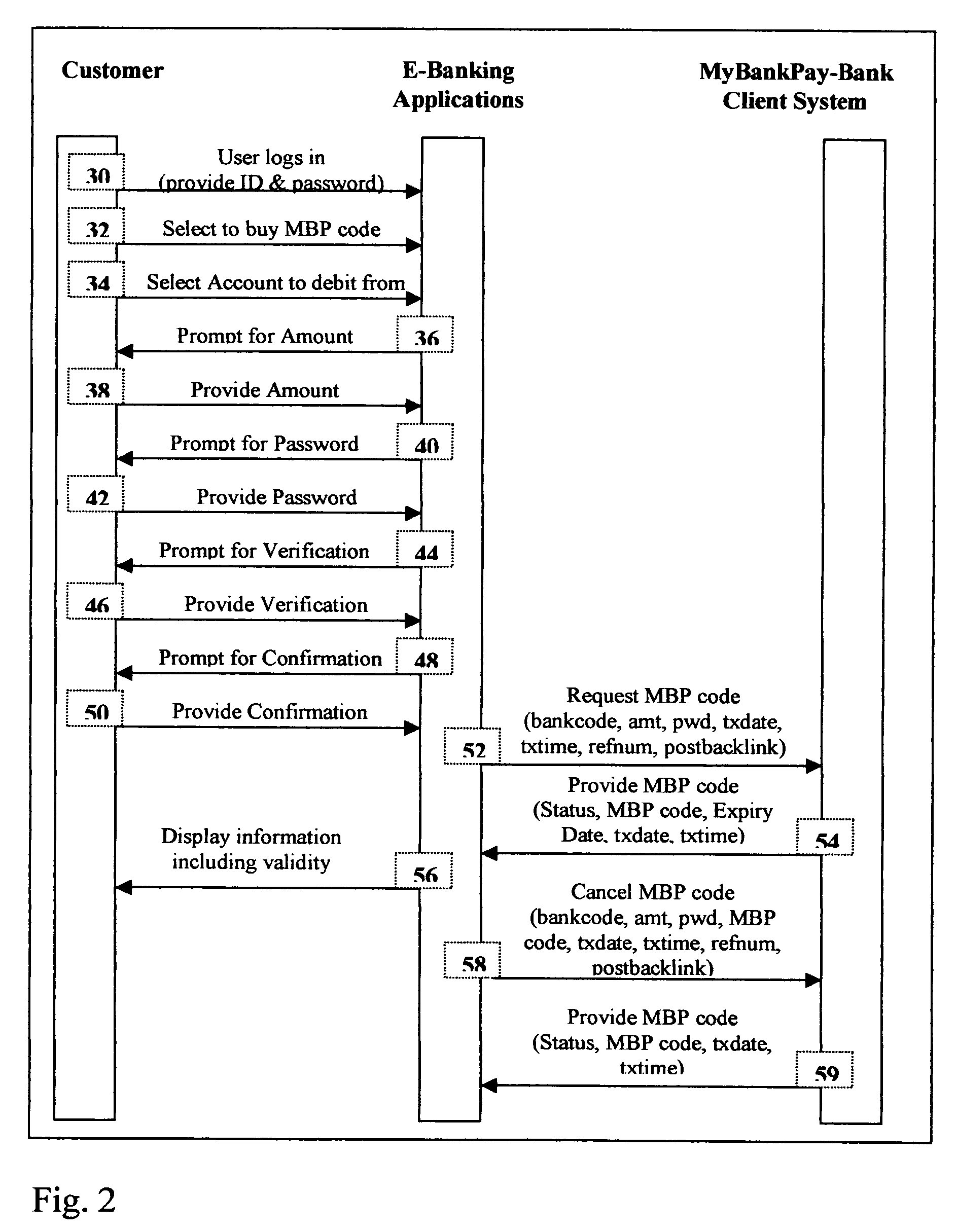

Fraud-free payment for Internet purchases

InactiveUS20060218091A1Encourage e-commerceCost of setting up account is avoidedFinanceDebit schemesCredit cardBank account

A simple, non-intrusive, fraud free payment method for customers to make Internet purchases without using credit cards or revealing personal information. Customers can purchase any specific dollar amount of pay codes via on-line purchase by logging into their financial institution and purchasing the codes, via phone banking (using mobile phone or fixed telephone line) or via Automated Teller Machine (ATM). There is no need for the customer to first open an account with the payment service. The easy and fast set-up of a secure payment gateway for website merchants to receive payments for their goods purchased at their websites, eliminates the need of setting up a merchant account, chargeback and being penalized by banks for chargeback on sales. The amount due to the web merchant from the Internet transaction is credited directly into the merchant's bank account when the transaction and payment is approved by the customer's bank.

Owner:CHOY HENG KAH

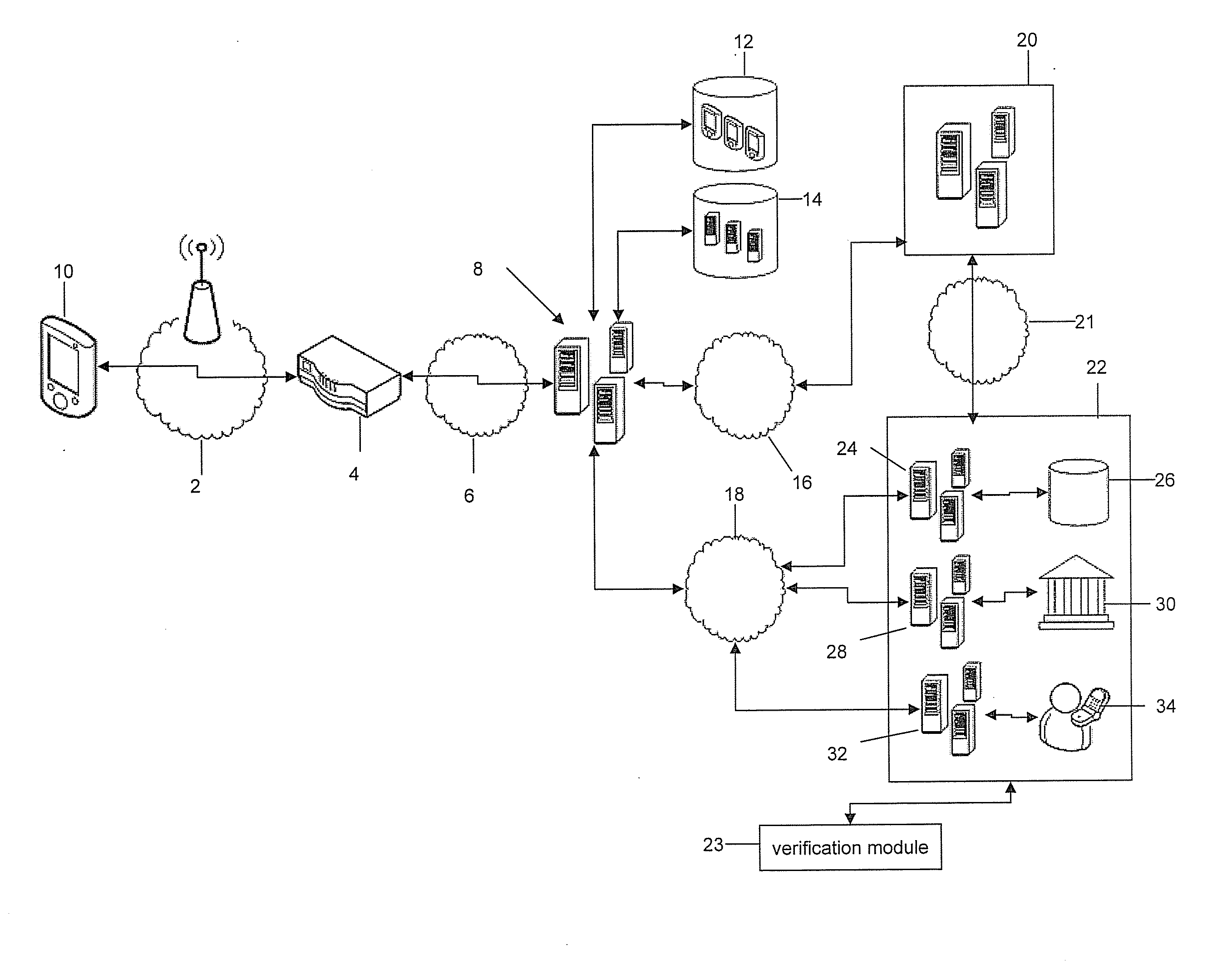

System and method for secured communications between a mobile device and a server

The present systems and methods provide for secured communication between a mobile device and a server / gateway. The systems and methods can be used, for example, as a way to confirm whether or not a transaction was actually authorized by the user, thereby settling a chargeback dispute for a previously executed transaction. The method comprises receiving the dispute regarding the transaction including associated transaction data, and retrieving a digital signature associated with the transaction data, the digital signature computed by signing the transaction data. The digital signature is then verified using a public key, wherein the public key corresponds to a private key stored on a mobile device. It is then determined whether or not the transaction is fraudulent based on a verification result of the digital signature.

Owner:STICKY IO INC

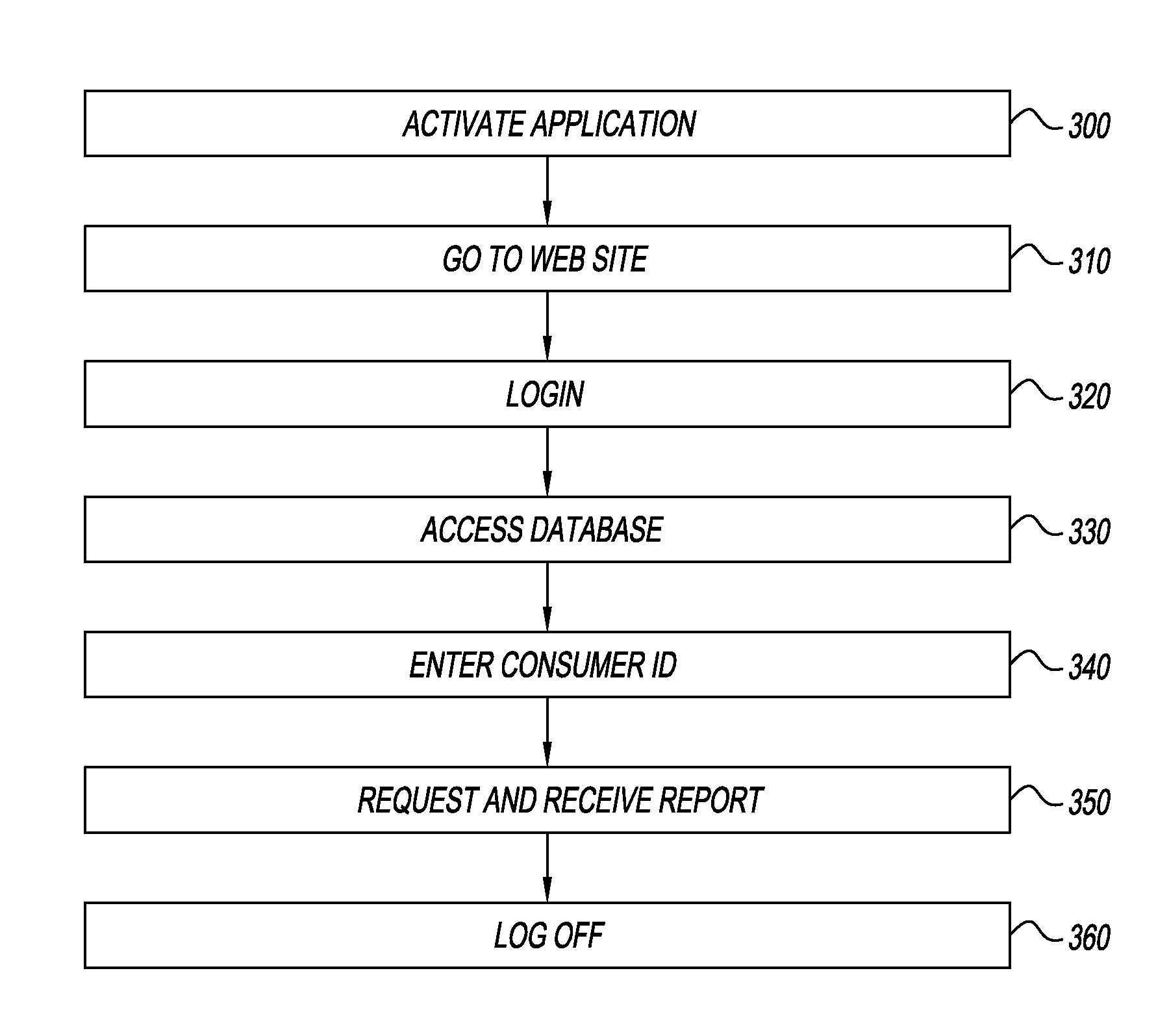

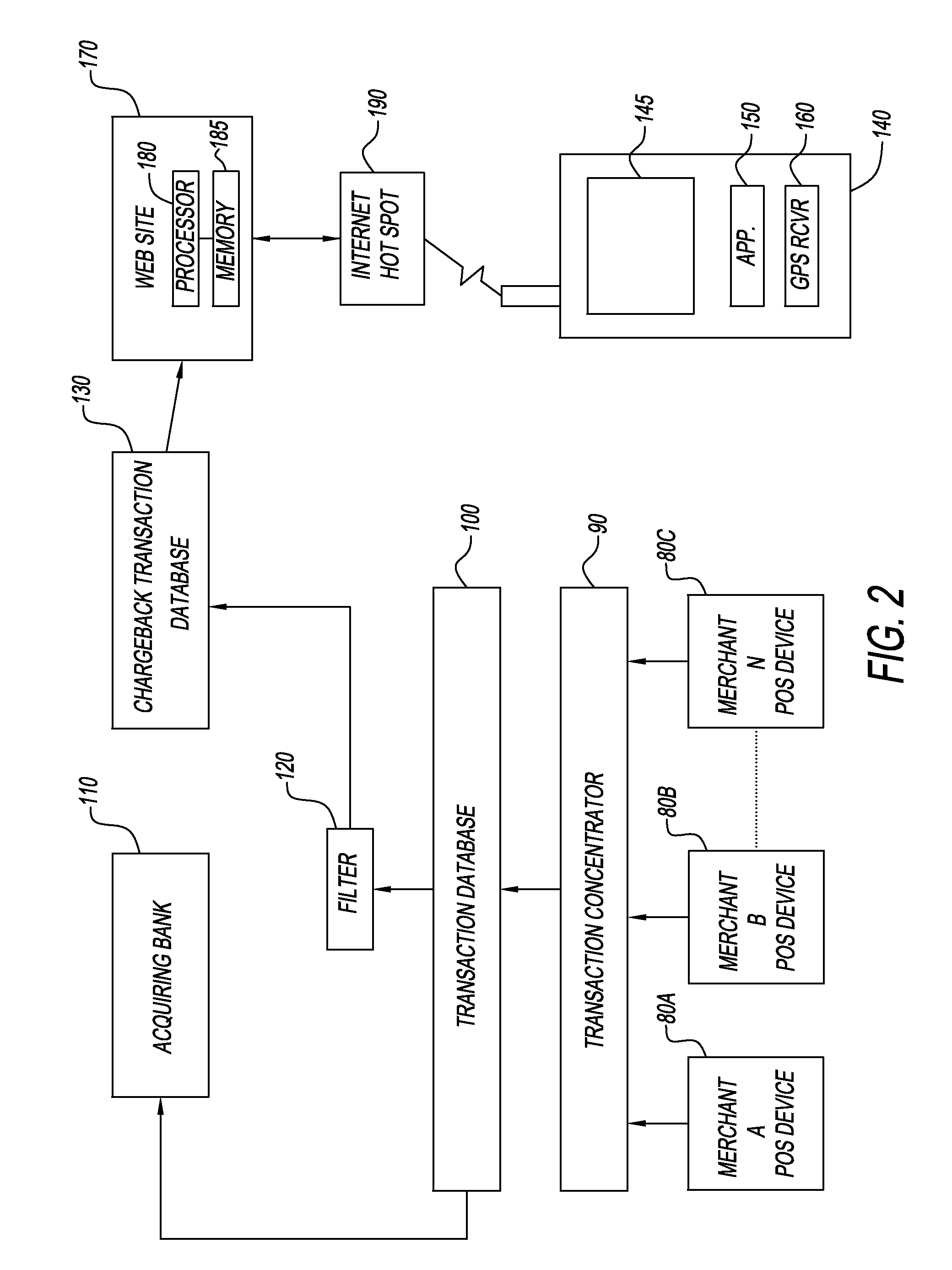

System and Method for Using Credit/Debit Card Transaction Data to Determine Financial Health of a Merchant

A system and a method for determining financial health of a selected merchant based on chargeback transaction data in a database of transactions. An indication, which can be a number representative of financial health, is generated by comparing the number of chargeback transactions for the selected merchant with the total number of transactions not involving chargebacks for that merchant. The comparison can be made during various time periods, such as from a month to a year. The indication representative of financial health for selected merchants may be made available to a cardholder or consumer, especially a cardholder who has purchased one or more undelivered forward-sold goods and / or services from the merchant. The system and method helps ensure that a cardholder is informed in a timely manner of bankruptcy or insolvency of a merchant, thereby allowing the cardholder to take remedial action.

Owner:MASTERCARD INT INC

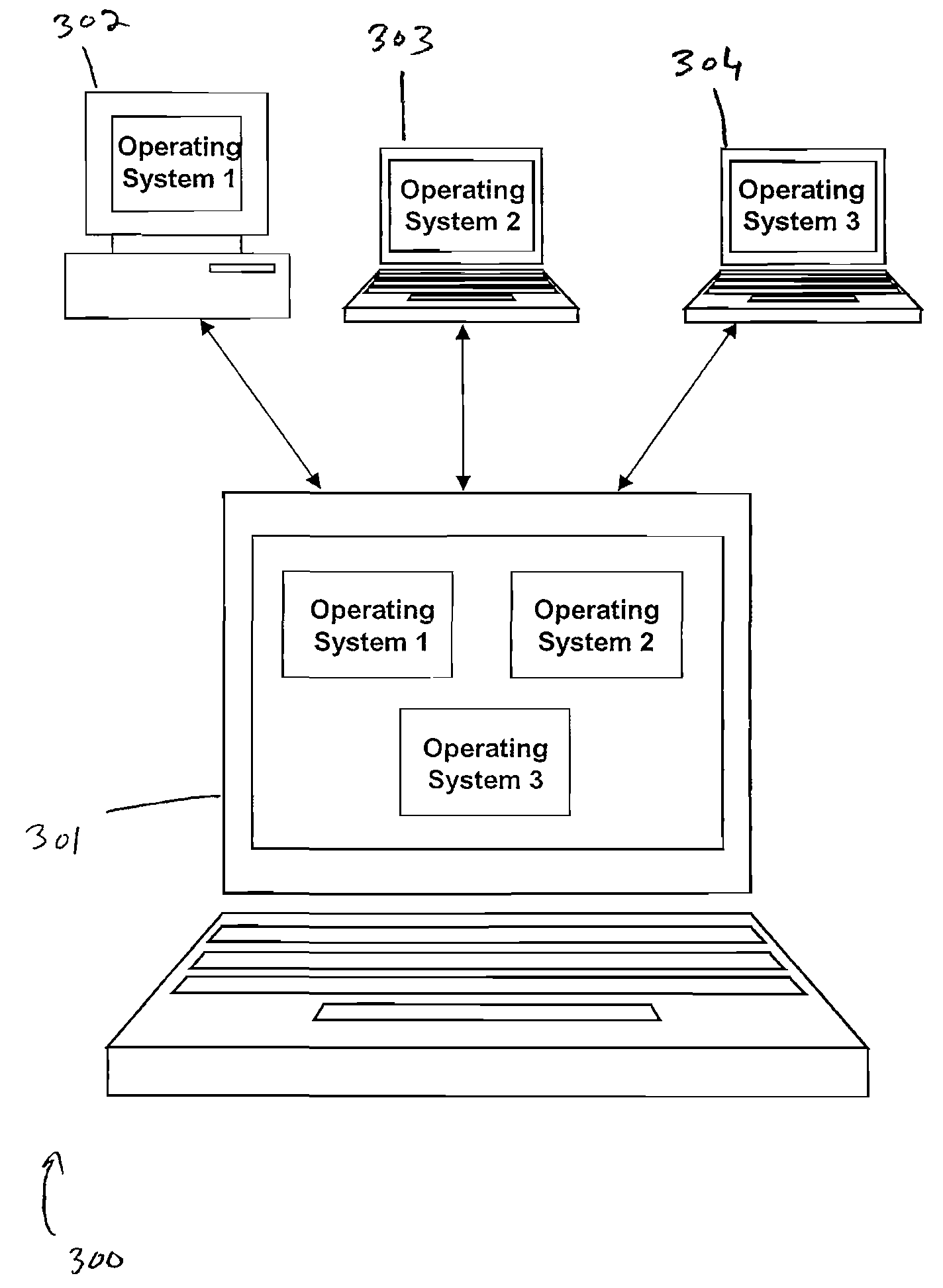

Method, system and apparatus for calculating chargeback for virtualized computing resources

InactiveUS20120246646A1Efficiently and accurately utilizeOvercome limitationsBilling/invoicingSoftware simulation/interpretation/emulationVirtualizationCost recovery

Owner:QUEST SOFTWARE INC

System and method for authenticating transactions through a mobile device

A user may claim to have not made or allowed a transaction and that the transaction was made in error. Where it appears the user has not authorized the transaction, the funds of the transaction are returned to the user, or are charged back. Systems and methods provide a way to confirm whether or not a transaction was actually authorized by the user, thereby settling a chargeback dispute for a previously executed transaction. The method comprises receiving the dispute regarding the transaction including associated transaction data, and retrieving a digital signature associated with the transaction data, the digital signature computed by signing the transaction data. The digital signature is then verified using a public key, wherein the public key corresponds to a private key stored on a mobile device. It is then determined whether or not the transaction is fraudulent based on a verification result of the digital signature.

Owner:SALT TECH

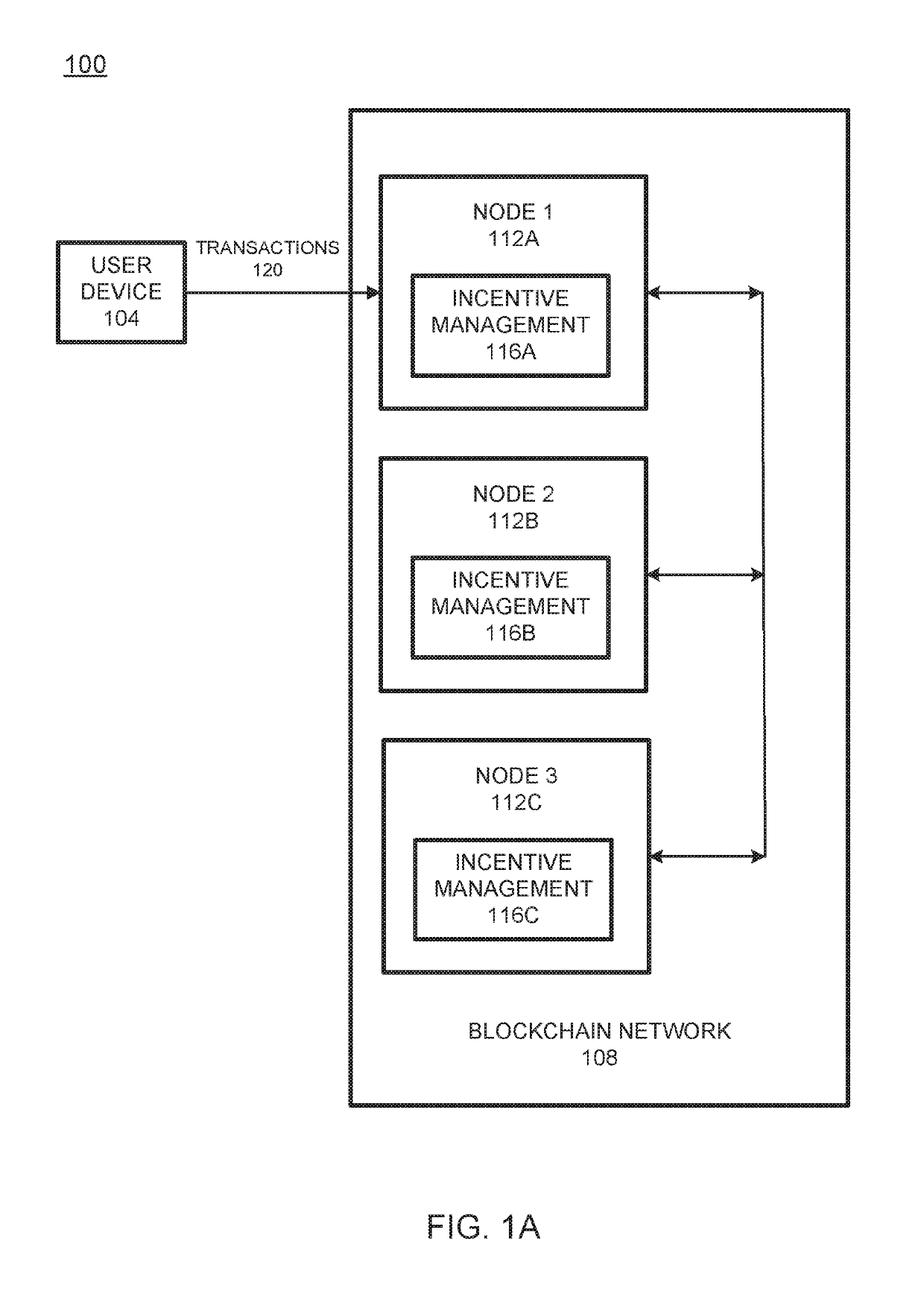

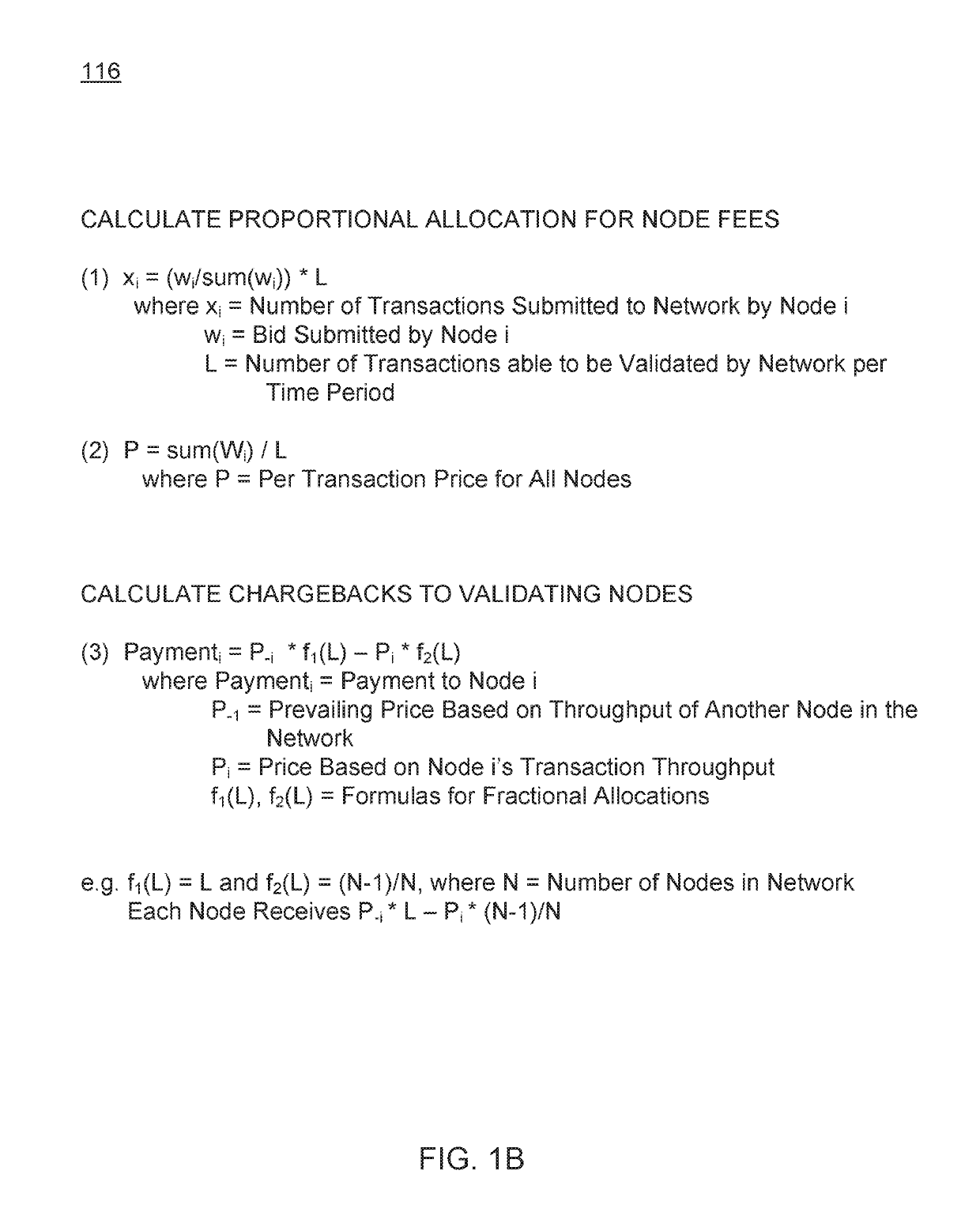

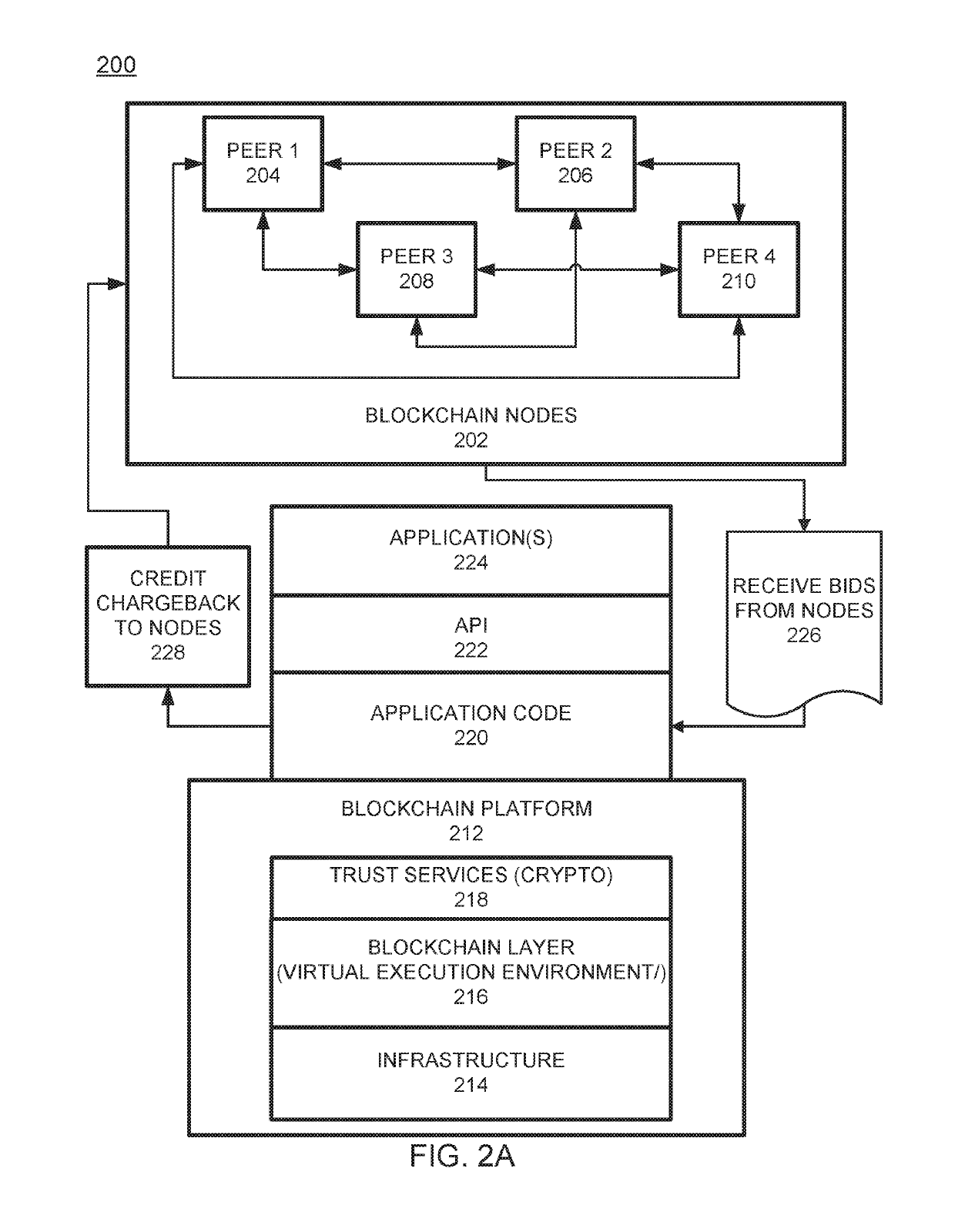

Resource equity for blockchain

An example operation may include one or more of receiving, by a blockchain network, a transaction from a user device, submitting bids for validating the transaction to nodes within the blockchain network, from one or more validating nodes, calculating transaction parameters based on the submitted bids, by the one or more validating nodes, validating, by the one or more validating nodes, the transaction; executing, by a node within the blockchain network, the transaction, calculating a chargeback for the transaction, and distributing the chargeback to at least one of the one or more validating nodes.

Owner:IBM CORP

Methods and systems for verifying regulation compliance

A computer and a computer-based method for verifying compliance of transaction data for a chargeback transaction with a set of regulations is provided. The method includes storing transaction data and a plurality of regulation sets wherein each regulation set is associated with a reason code and defines compliance of a chargeback transaction with the associated reason code, and receiving a chargeback message for the chargeback transaction wherein the chargeback message includes an assigned reason code for requesting the chargeback transaction and a transaction identifier for identifying transaction data associated with the chargeback transaction. The method further includes retrieving transaction data based on the transaction identifier, retrieving a regulation set wherein the retrieved regulation set is associated with the assigned reason code included within the received chargeback message, and verifying the assigned reason code assigned to the chargeback transaction by comparing the retrieved transaction data to the retrieved regulation set.

Owner:MASTERCARD INT INC

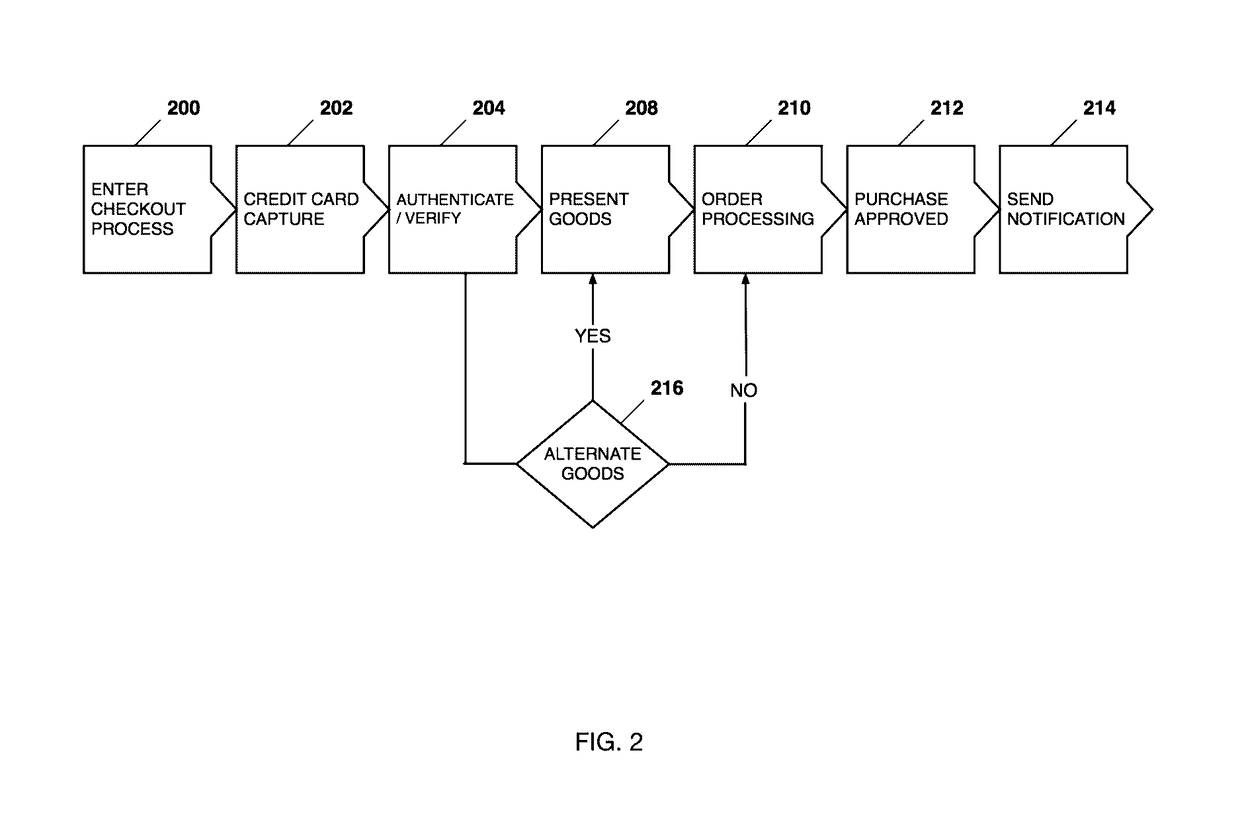

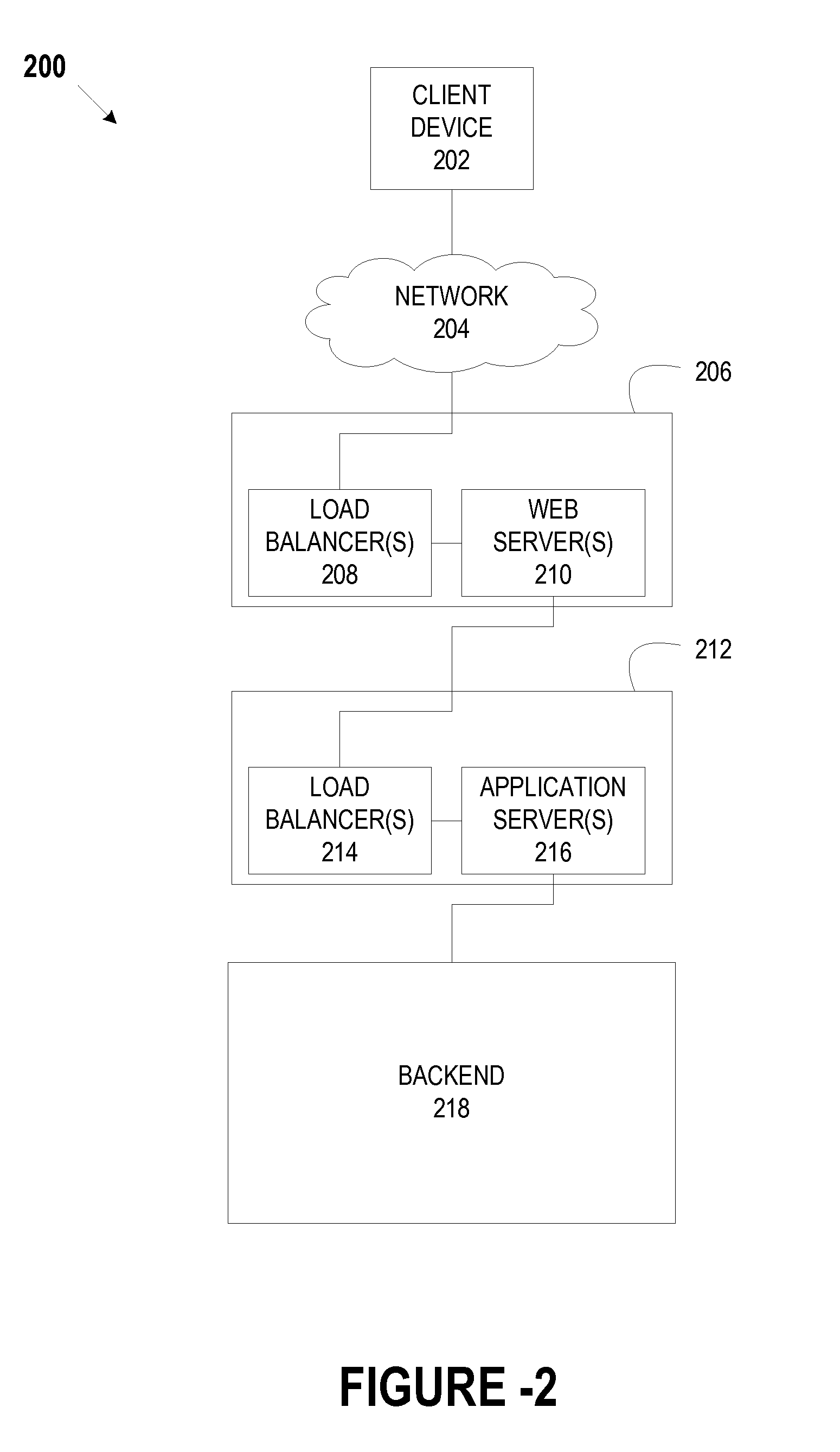

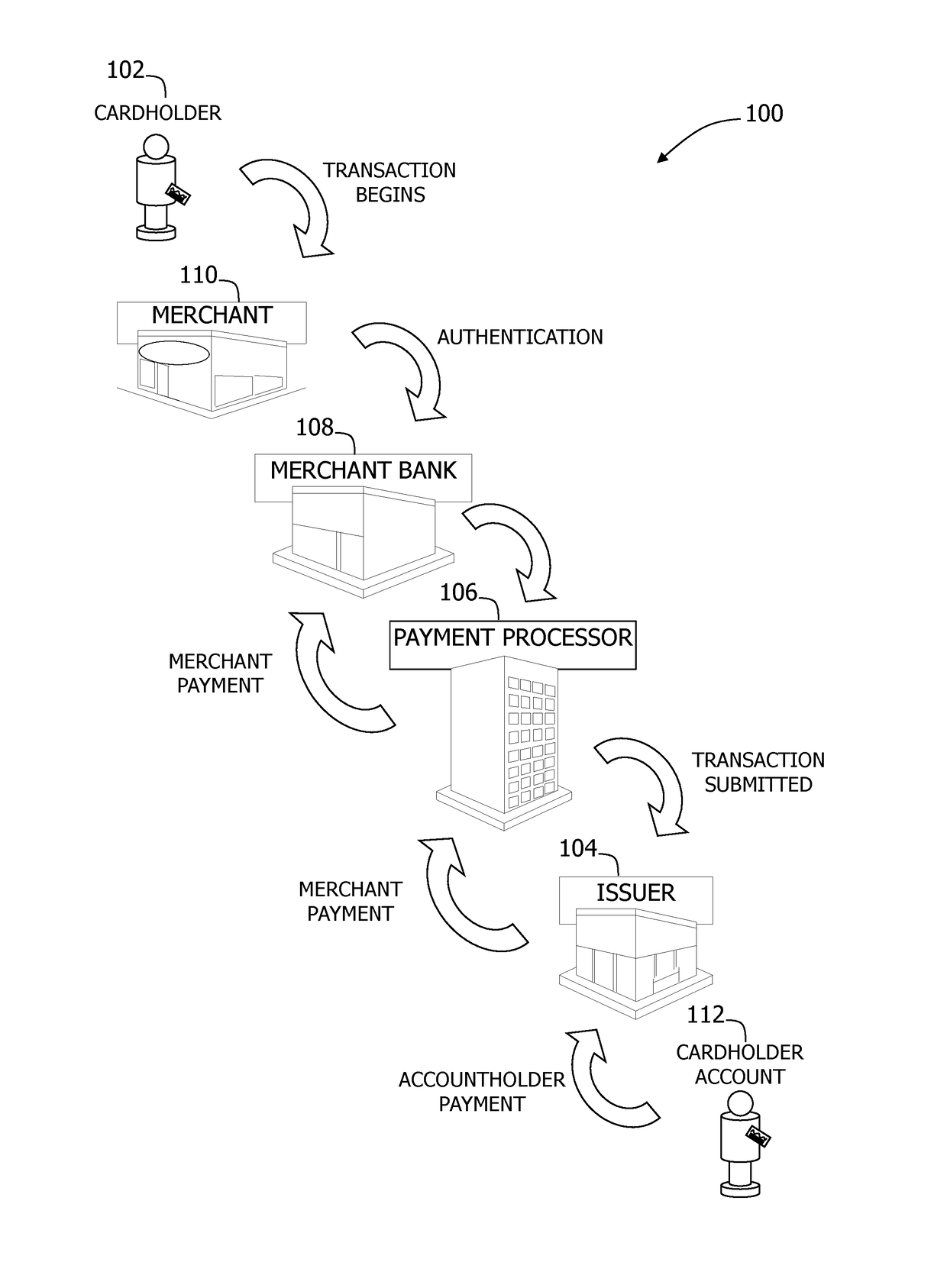

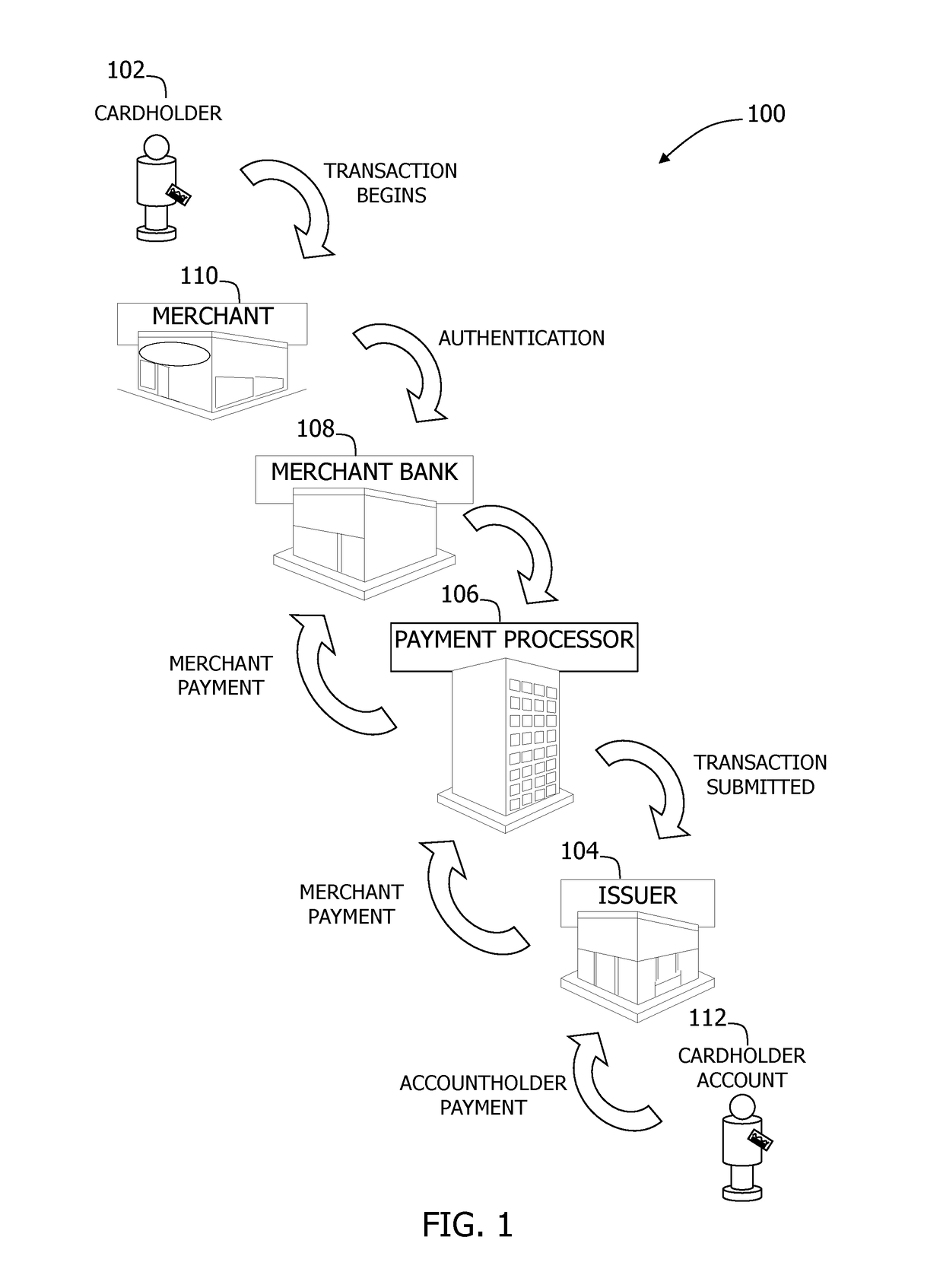

Process and system for providing automated responses for transaction operations

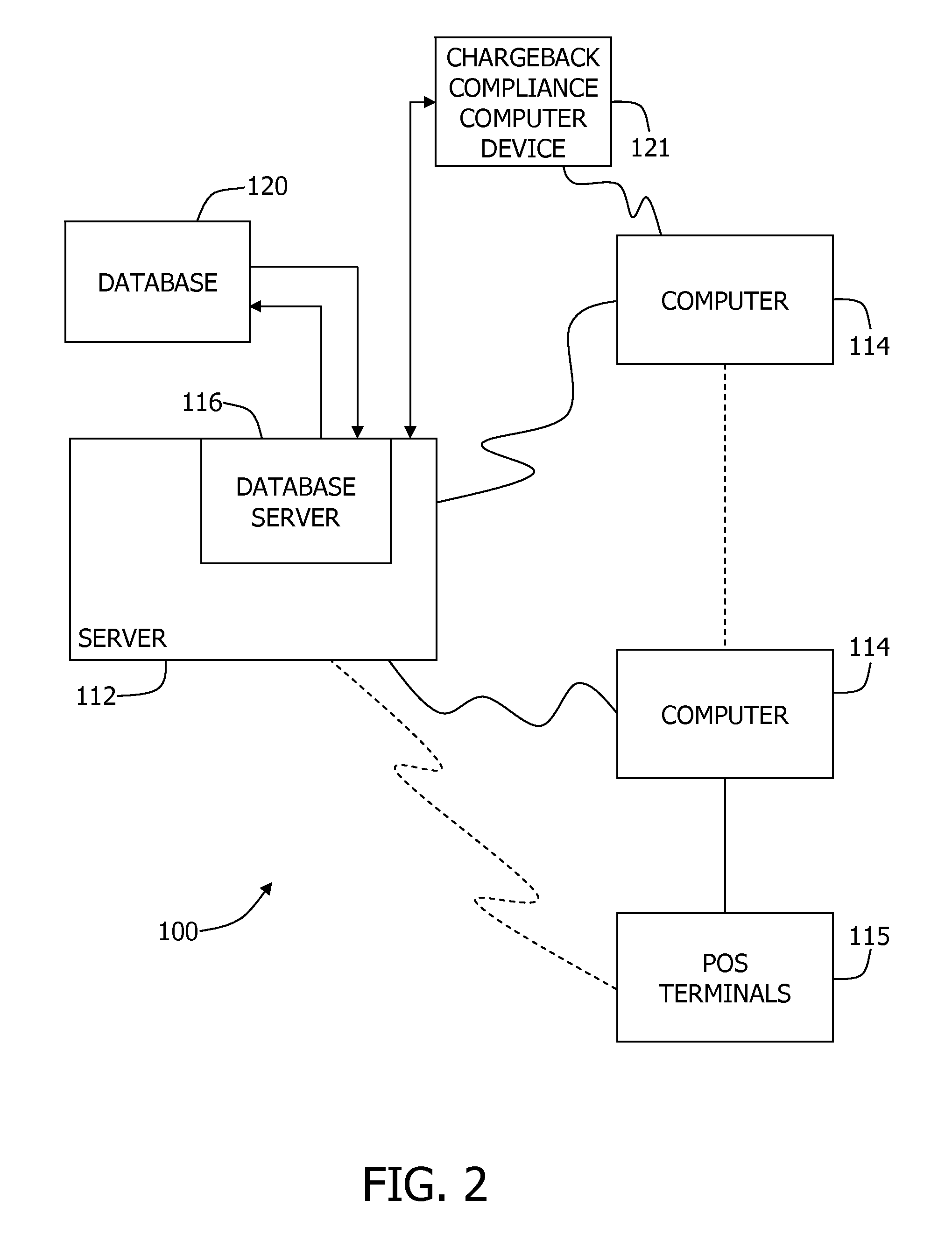

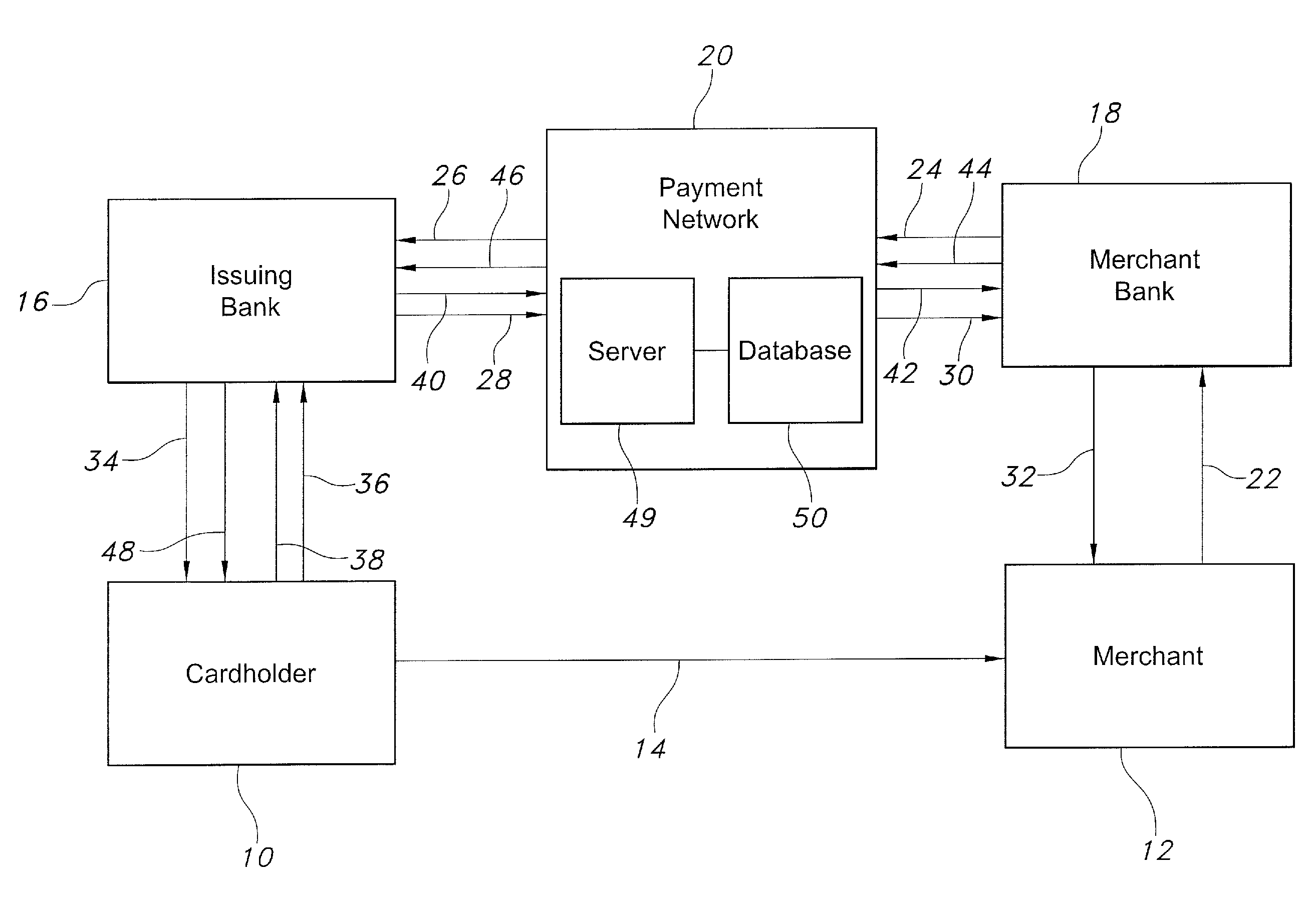

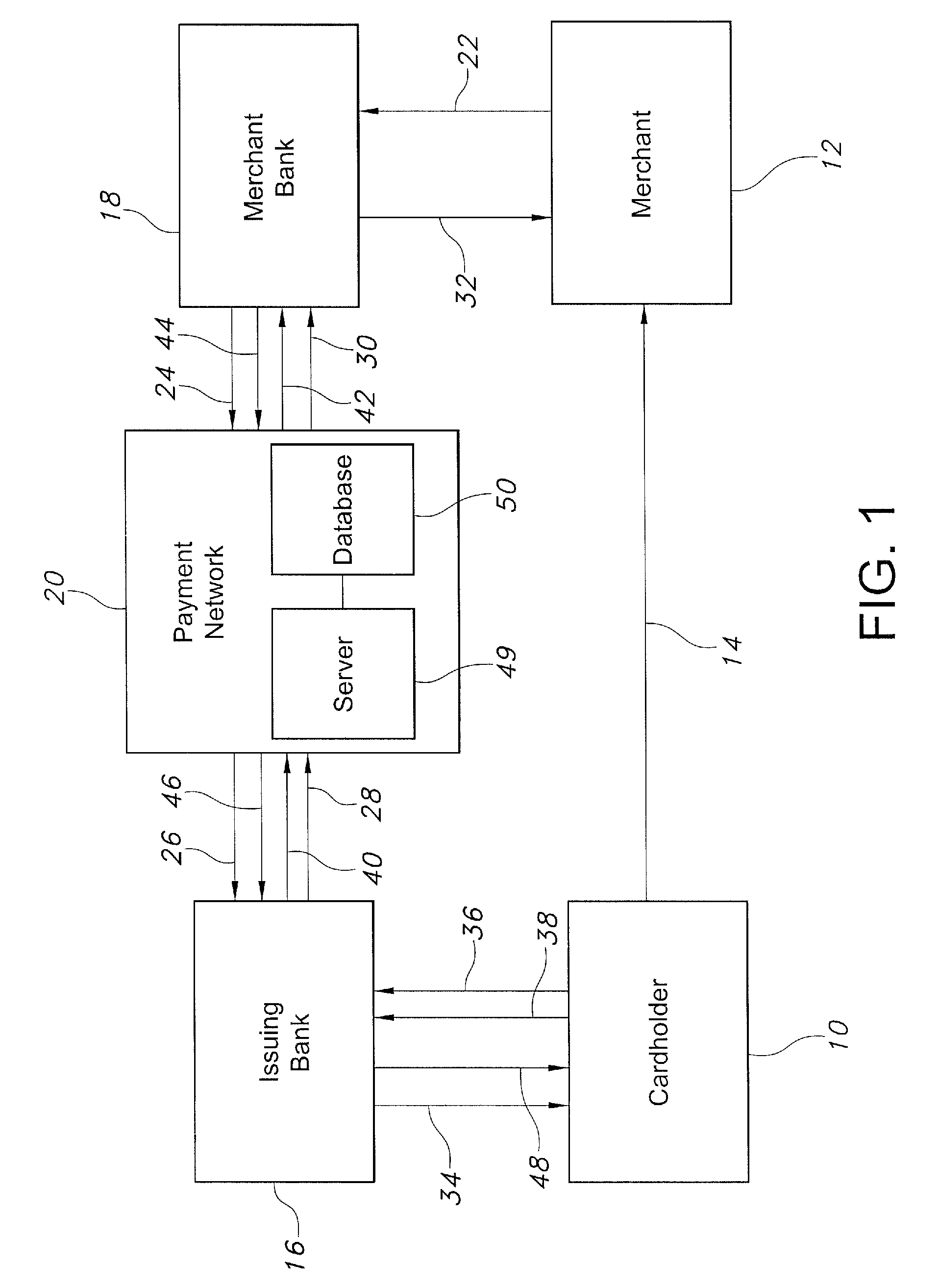

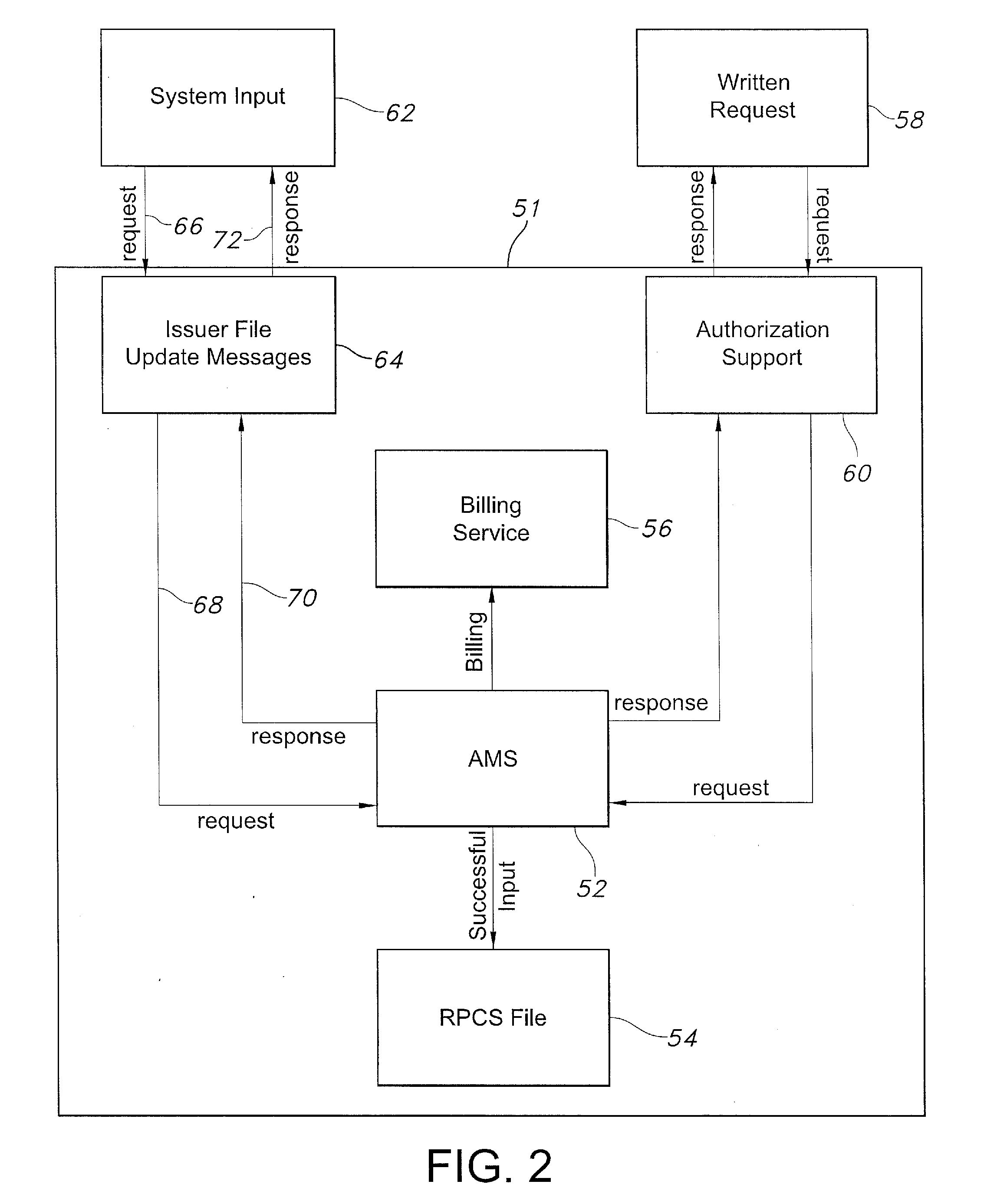

Various systems for managing chargeback, retrieval, and other requests from the card associations, issuing banks, merchant banks, or other financial institutions requiring a merchant's response are disclosed herein. Such systems may include various forms of hardware, software and manual processes intended to: (a) retrieve transaction requests; (b) retrieve merchant's transaction data; (c) gather merchant's data and compile with normalized transaction request data; (d) create response cases; (e) provide merchant notifications; and (f) transmit responses to requestors. With the present invention, these often independent and incompatible processes, including their non-standard data formats, are normalized and compiled into compatible formats that integrate and facilitate the automation of substantially all aspects of a given chargeback process in one embodiment.

Owner:SIGNATURELINK

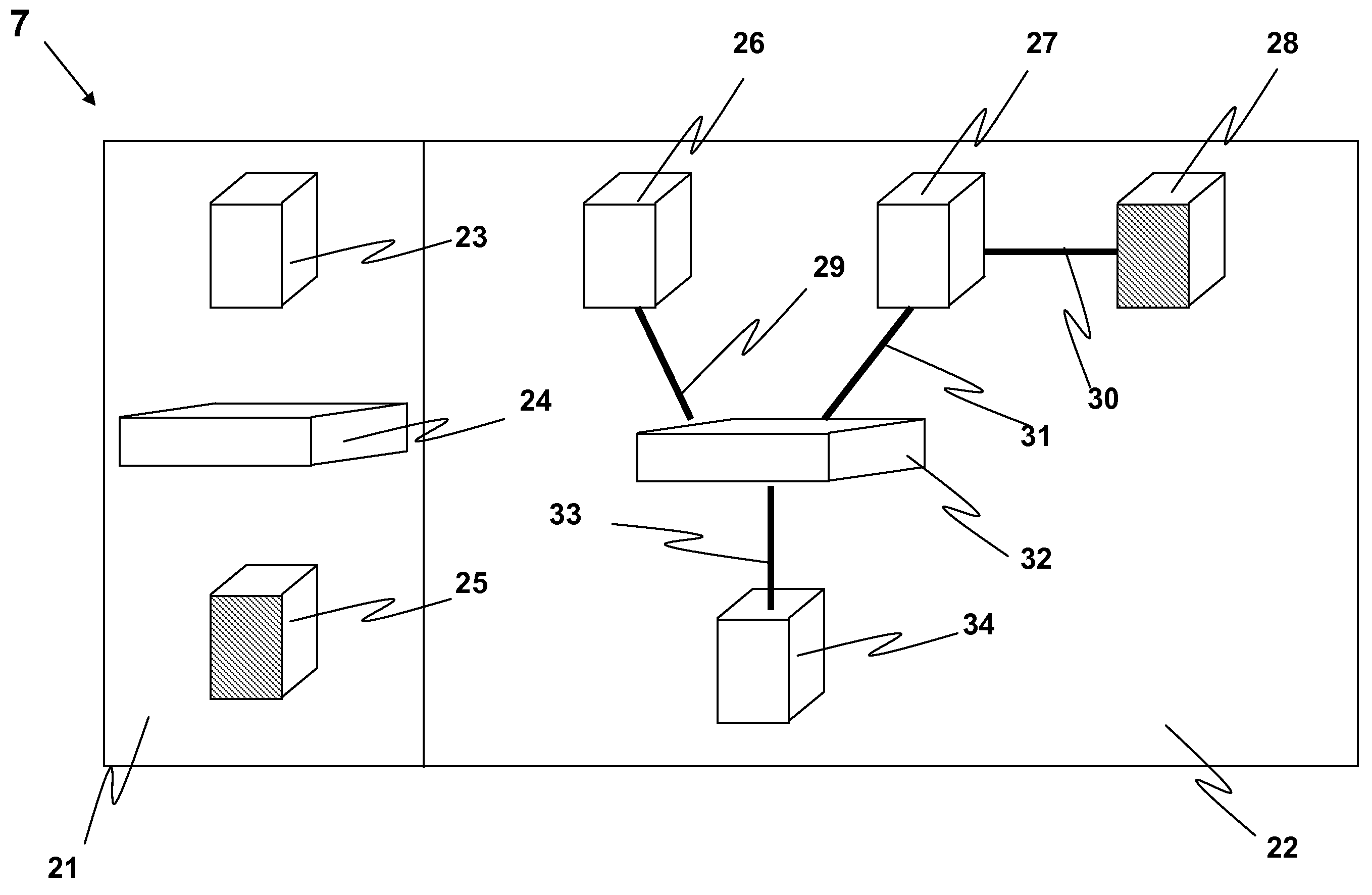

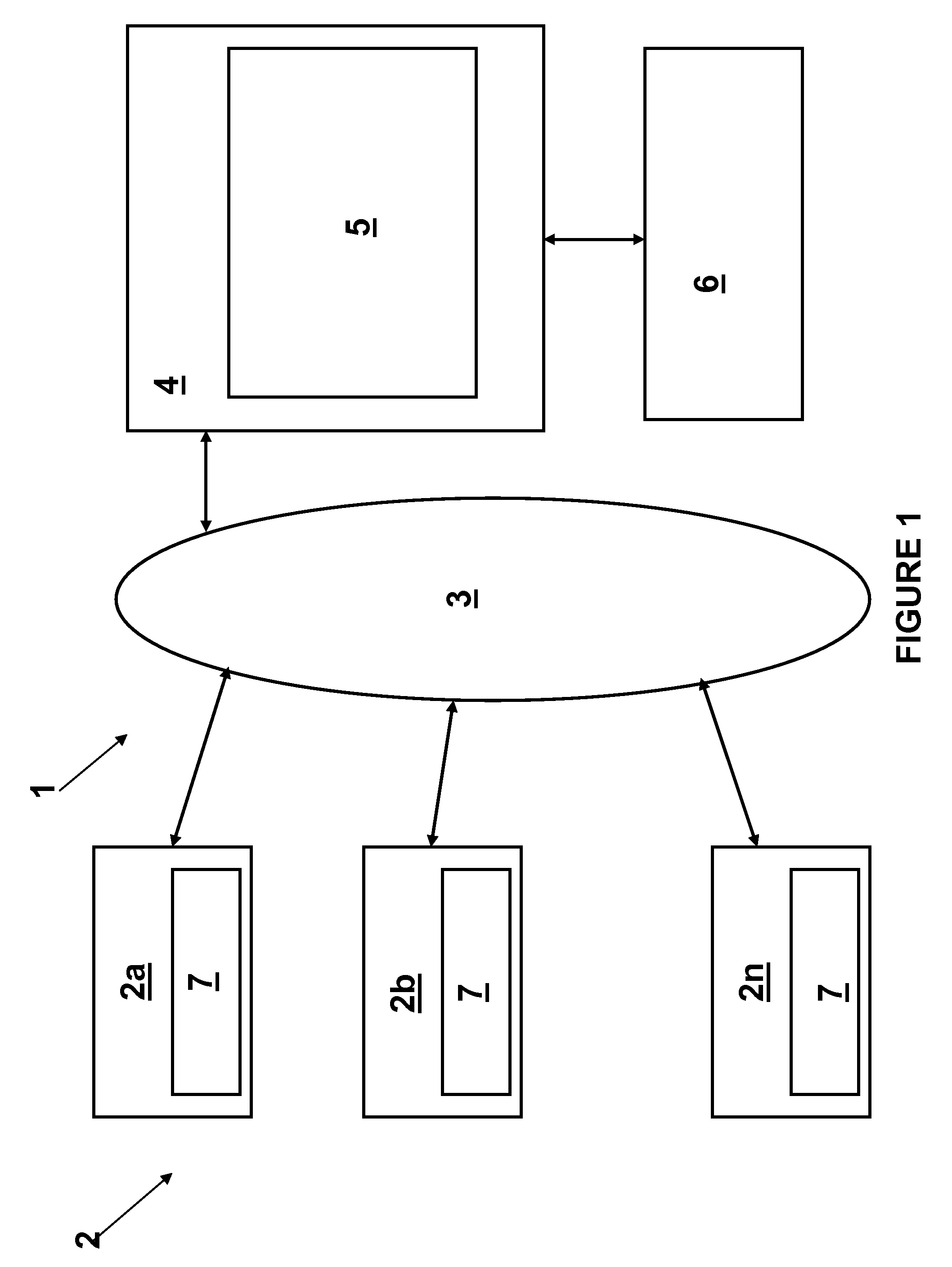

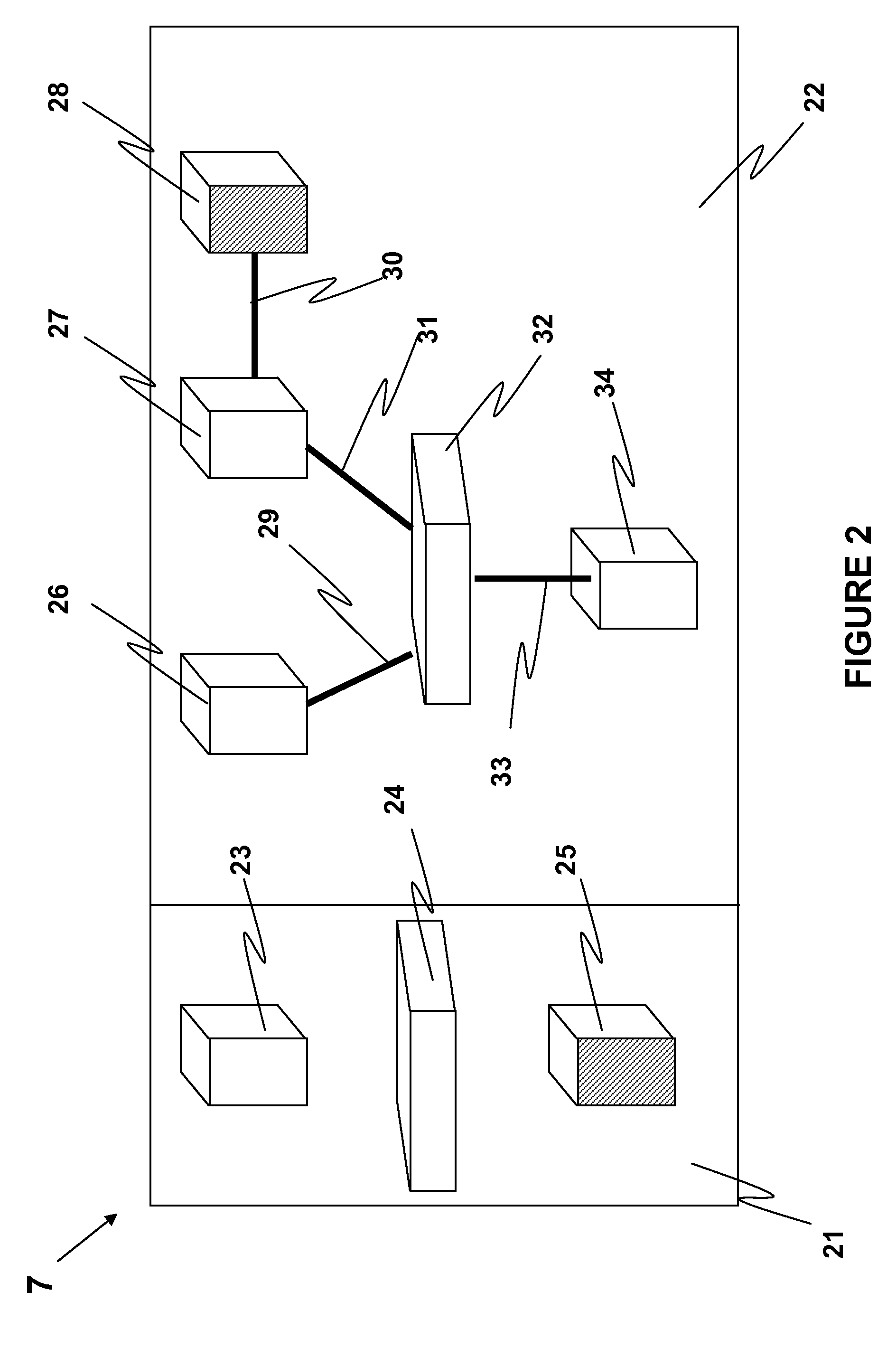

Method and system to model and create a virtual private datacenter

A virtual private datacenter system and method are provided. A method for capacity planning of a virtual private datacenter and a method for chargeback for use of the virtual private datacenter also are disclosed.

Owner:QLAYER

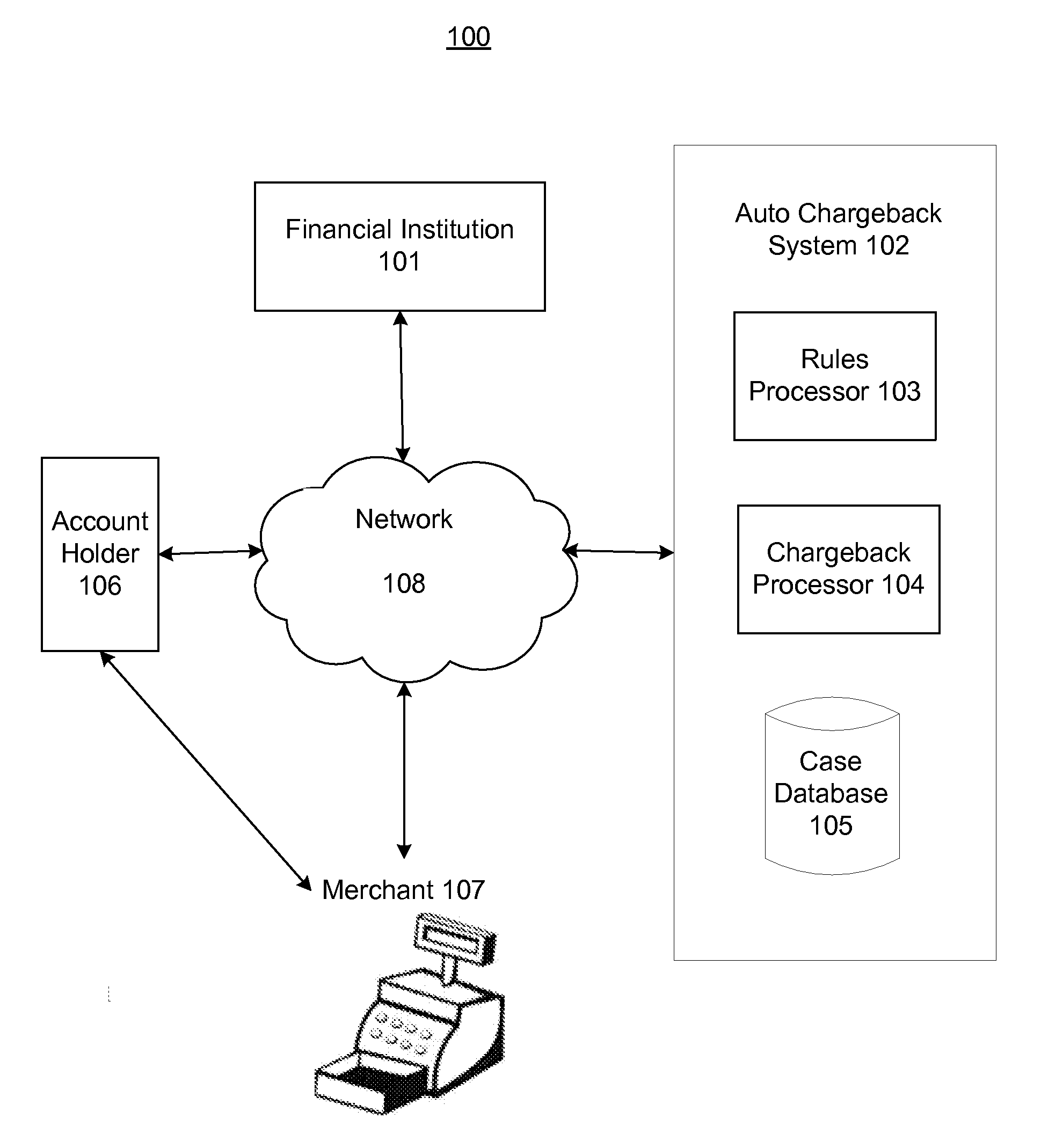

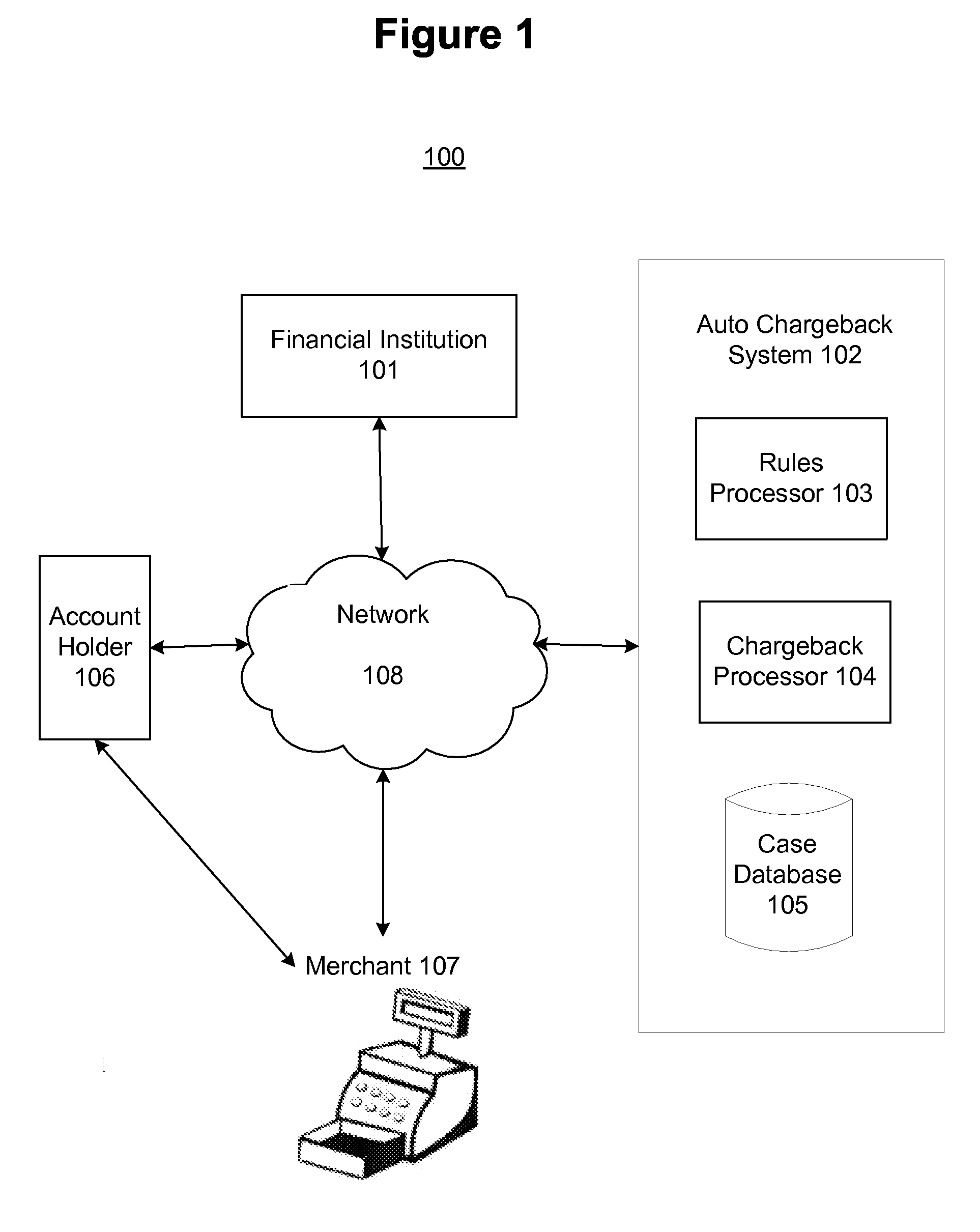

System and method for providing automated chargeback operations

Embodiments of the present disclosure provide systems and methods for automated chargeback processing, including hardware and software for storing, in a database, transaction data associated with one or more transactions in a queue, retrieving transaction data associated with one or more transactions stored in the queue, for each transaction in the queue, applying, using an automated chargeback processor, one or more rules to the transaction data, identifying, using the automated chargeback processor, the transaction data as eligible or ineligible for chargeback processing based on the one or more rules, determining, using the automated chargeback processor, whether additional documentation is required, and sending, via a network, instructions to perform a chargeback operation for an account associated with the transaction data.

Owner:CAPITAL ONE SERVICES

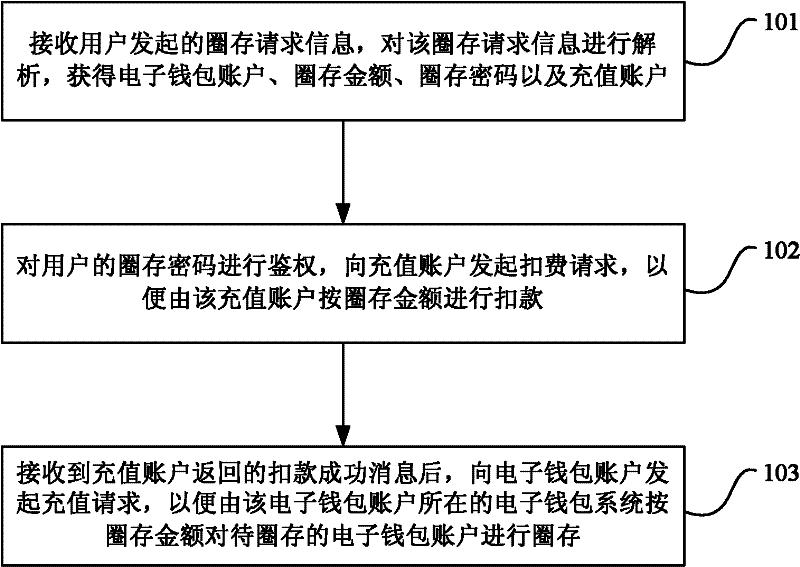

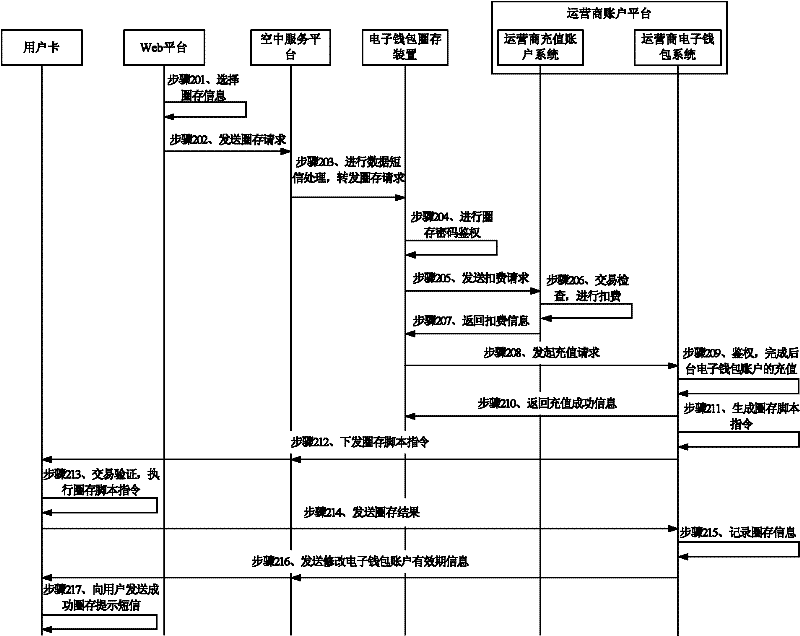

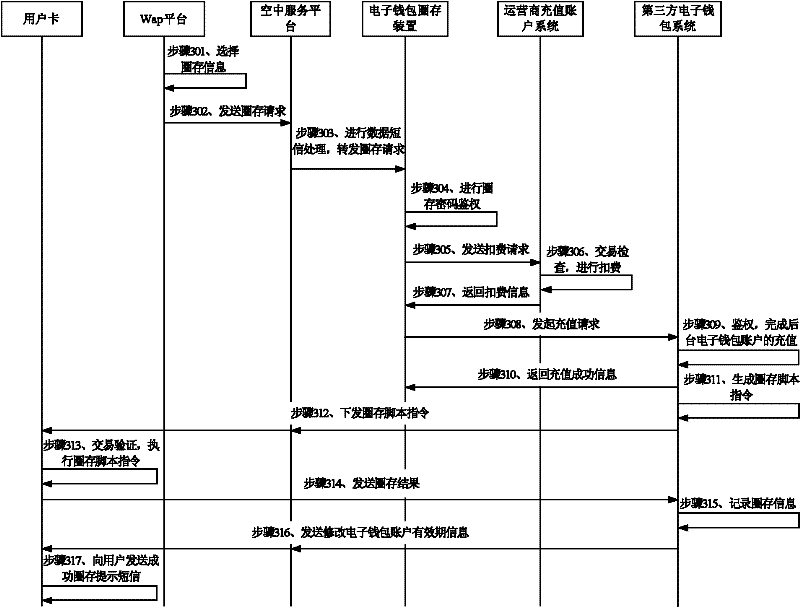

Method, device and system for depositing money in electronic wallet

InactiveCN102289893AImprove convenienceFacilitate unified monitoringComplete banking machinesPasswordComputer science

The invention discloses an electronic wallet transfer method, device and system. The method includes: receiving loading request information initiated by a user, analyzing the loading request information, and obtaining the electronic wallet account, loading amount, loading password and recharge account included in the loading request information; The above-mentioned loading password is used for authentication, and a deduction request is initiated to the recharging account system where the recharging account as the recharging source is located, so that the recharging account system can perform deduction according to the loading amount; after receiving the recharging account After the system returns the deduction success message, initiate a recharge request to the electronic wallet system where the electronic wallet account to be loaded is located, so that the electronic wallet system can load the electronic wallet account according to the loading amount . The technical scheme of the invention can effectively realize the loading of multi-channel and multi-recharging source accounts, and improve the convenience and safety of electronic wallet loading.

Owner:CHINA UNITED NETWORK COMM GRP CO LTD

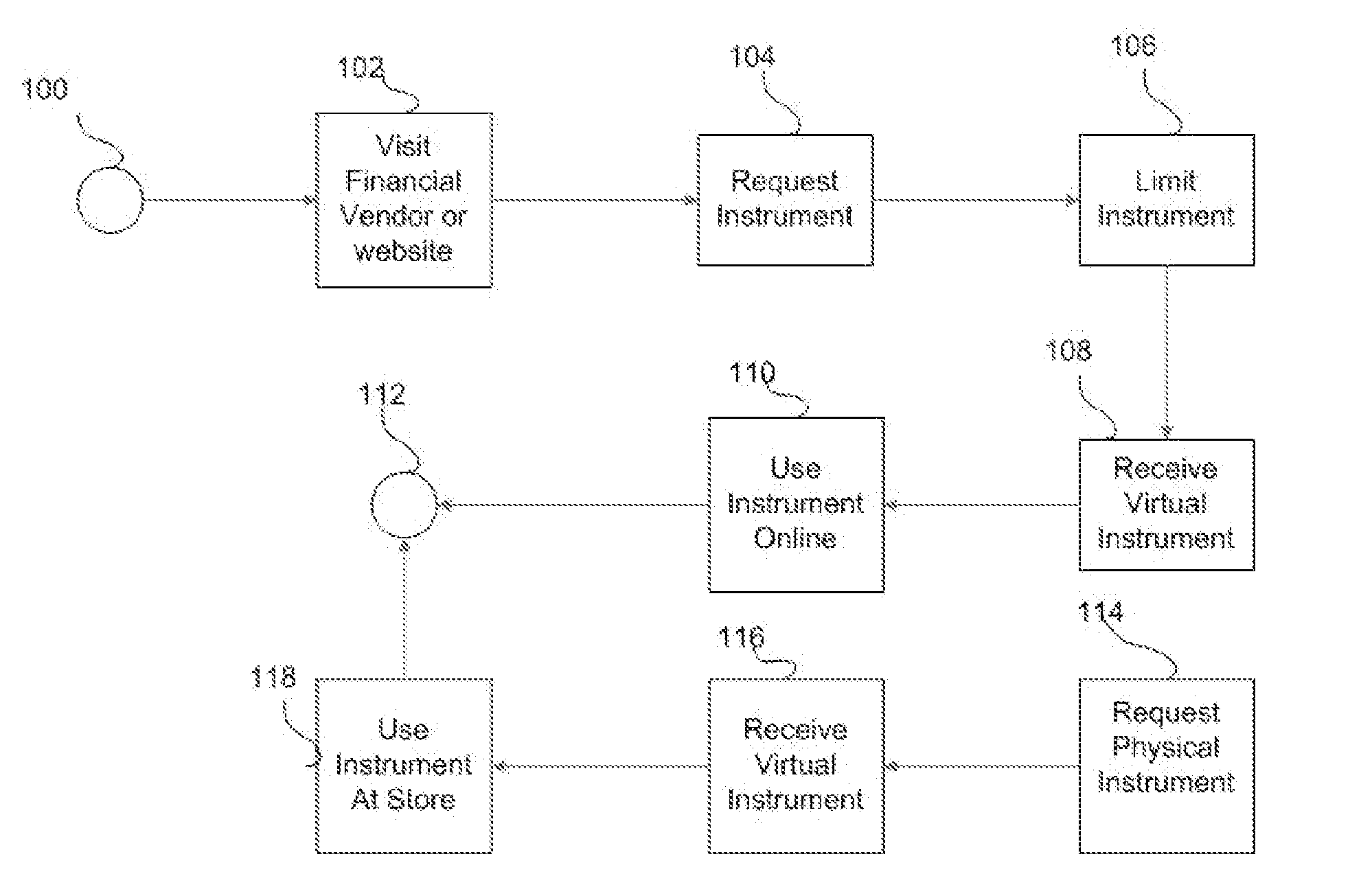

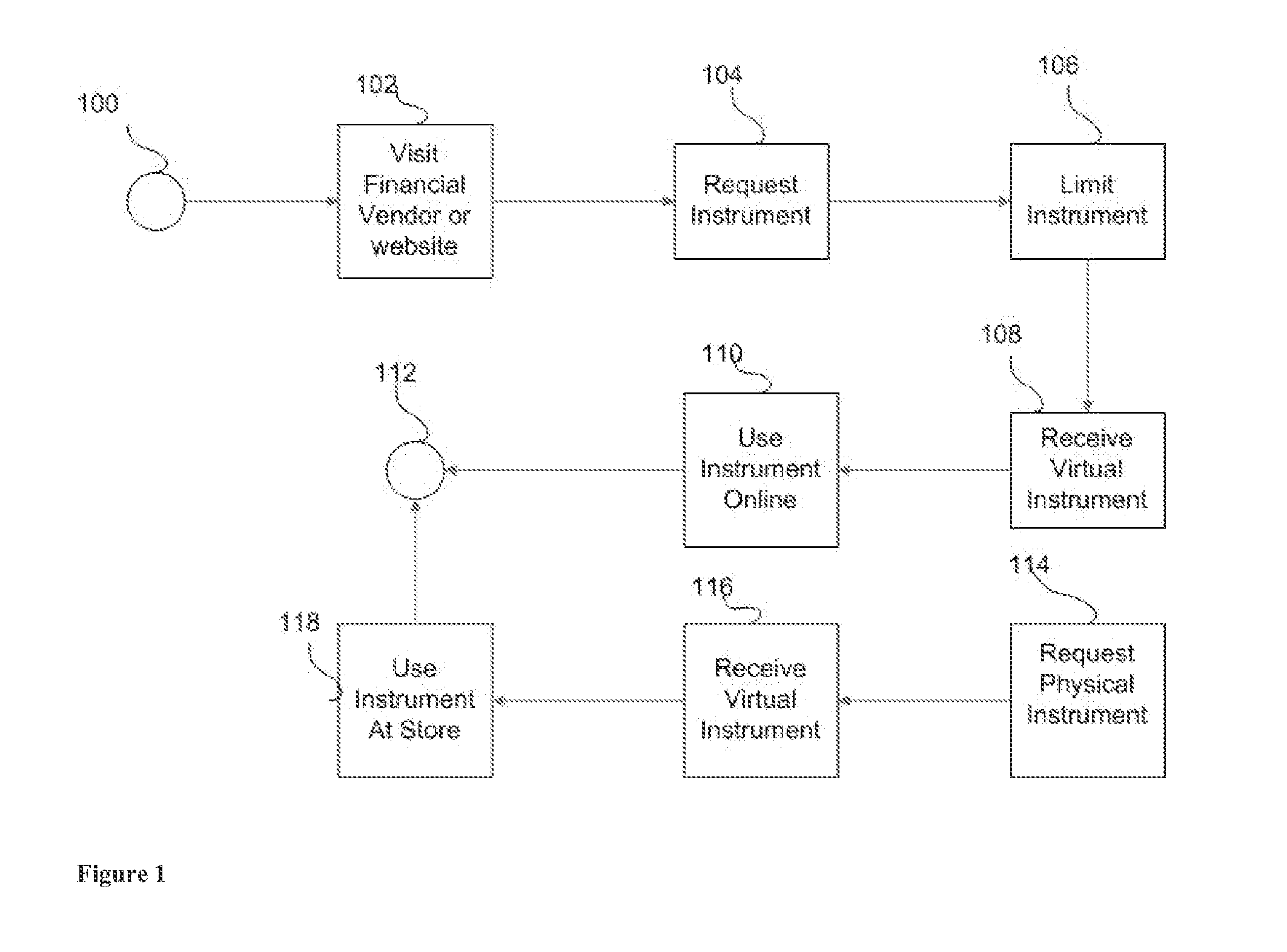

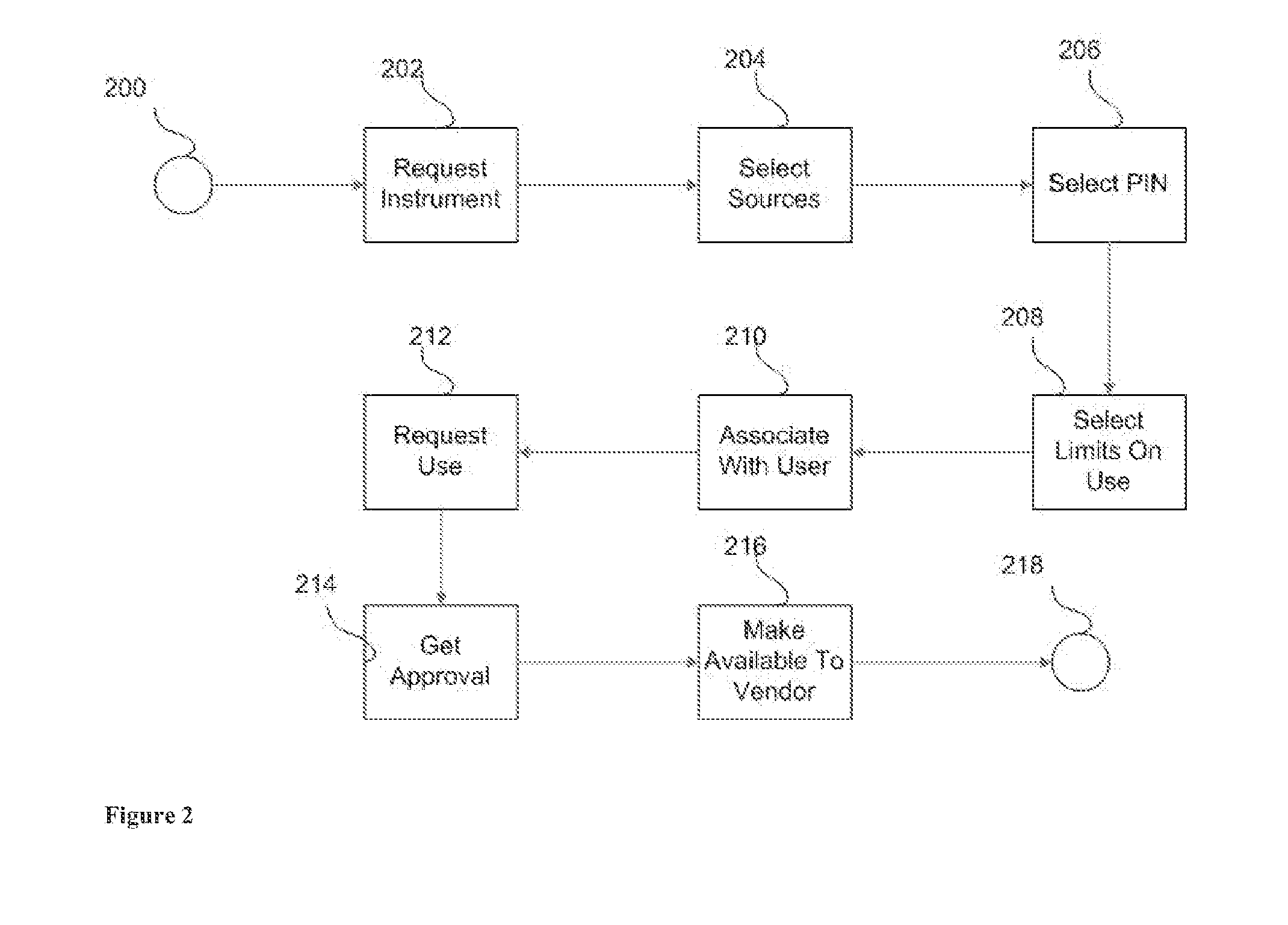

Method and Apparatus for On Demand Generation, Use and Transfer of Virtual Financial Instruments

Methods and systems are disclosed for enabling participants to generate, use, and transfer virtual financial instruments. The account holder requests the generation of a virtual financial instrument. The account holder selects a financial instrument to use as the source of funds for the virtual financial instrument, configures the use of the virtual financial instrument to be limited by a set of user-defined rules and expiration date, and selects a user of the instrument. The virtual instrument is transferred to the user. On request to perform a financial transaction, the user is authenticated, the transaction is validated that it is in within the limits of the user-defined rules, an authorization code is request if it is not, and the transaction is allowed. If a chargeback is necessary, the virtual financial instrument and the account is updated if the instrument has not expired, just the account otherwise.

Owner:MOBIDOUGH

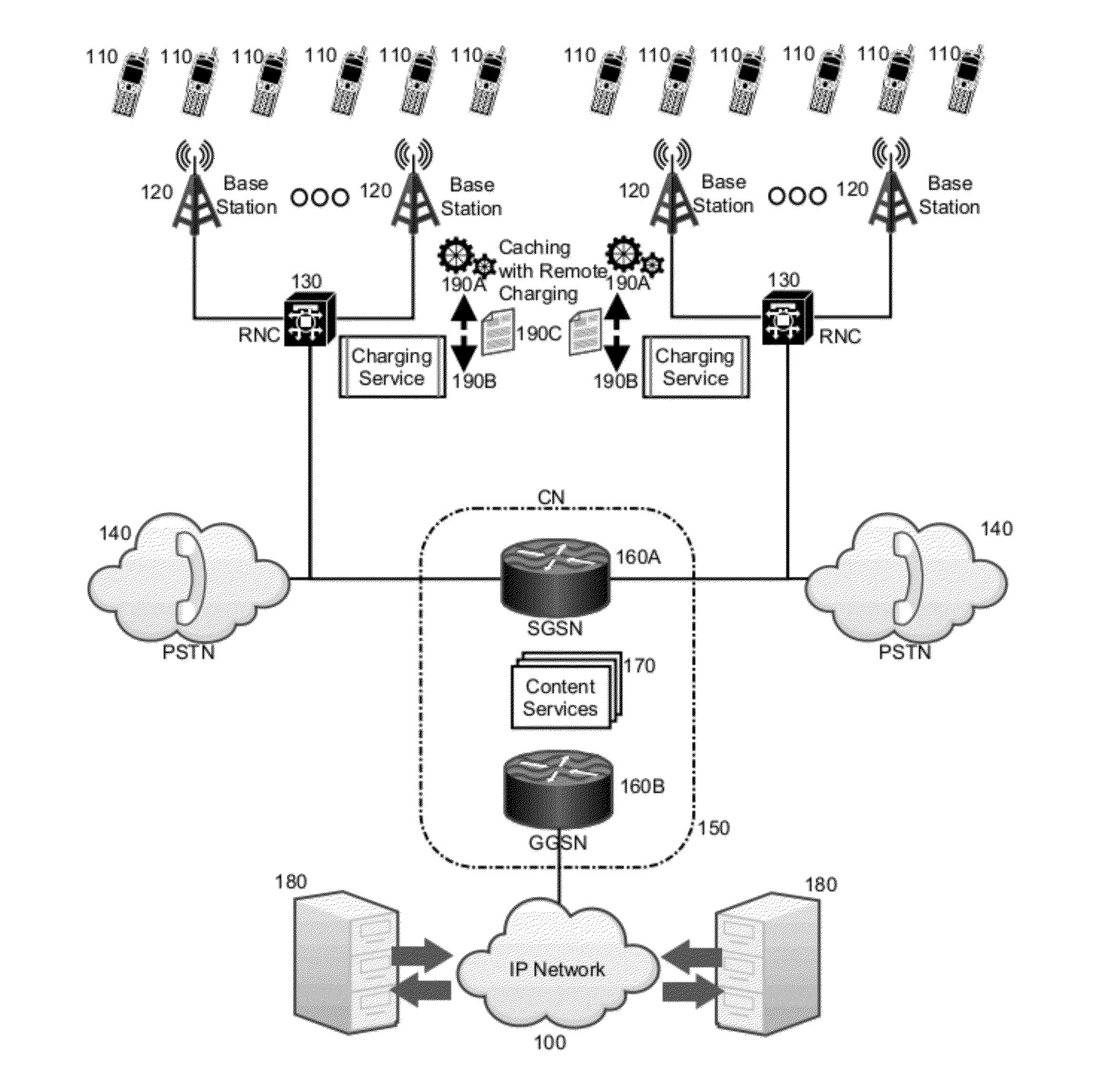

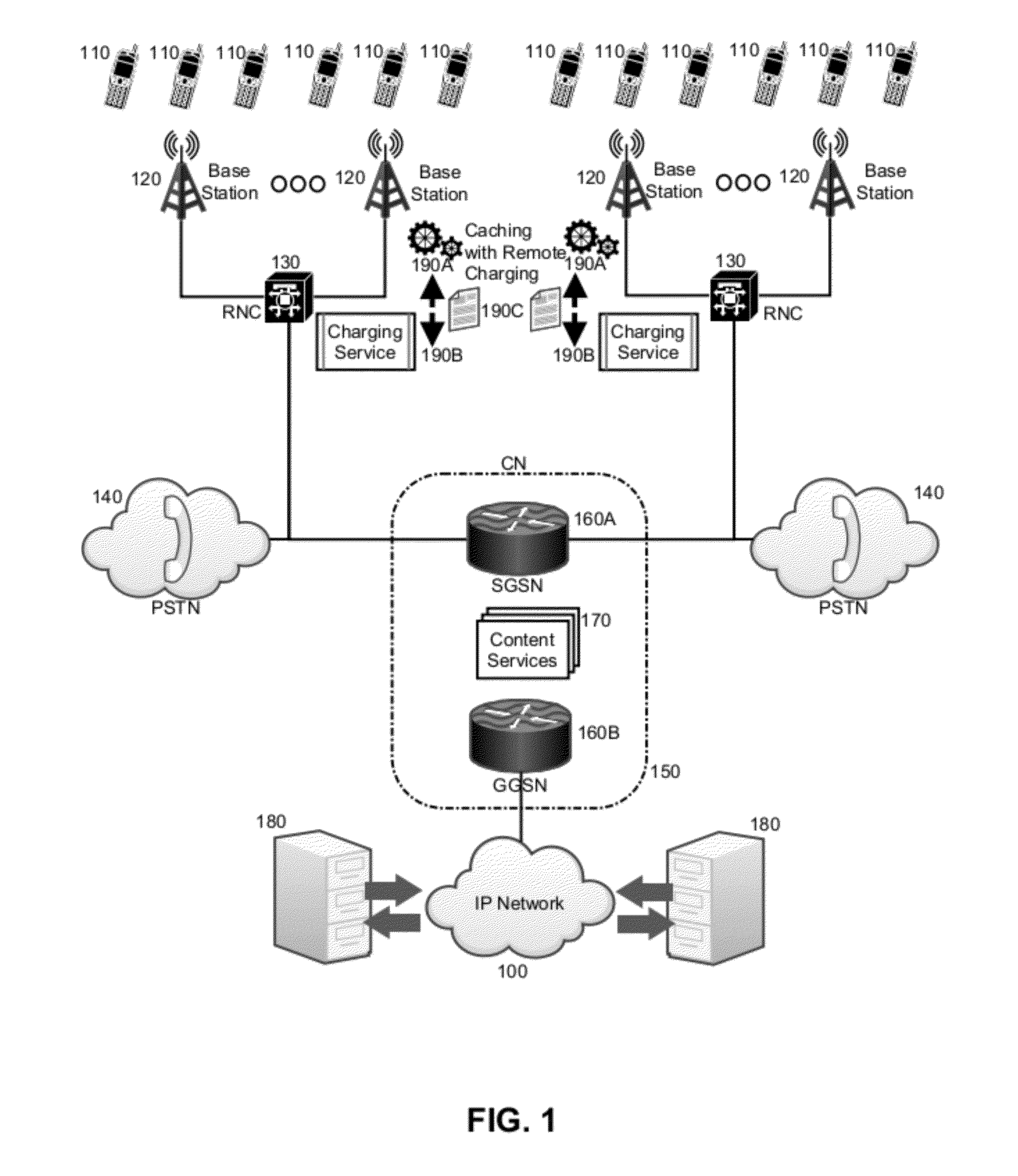

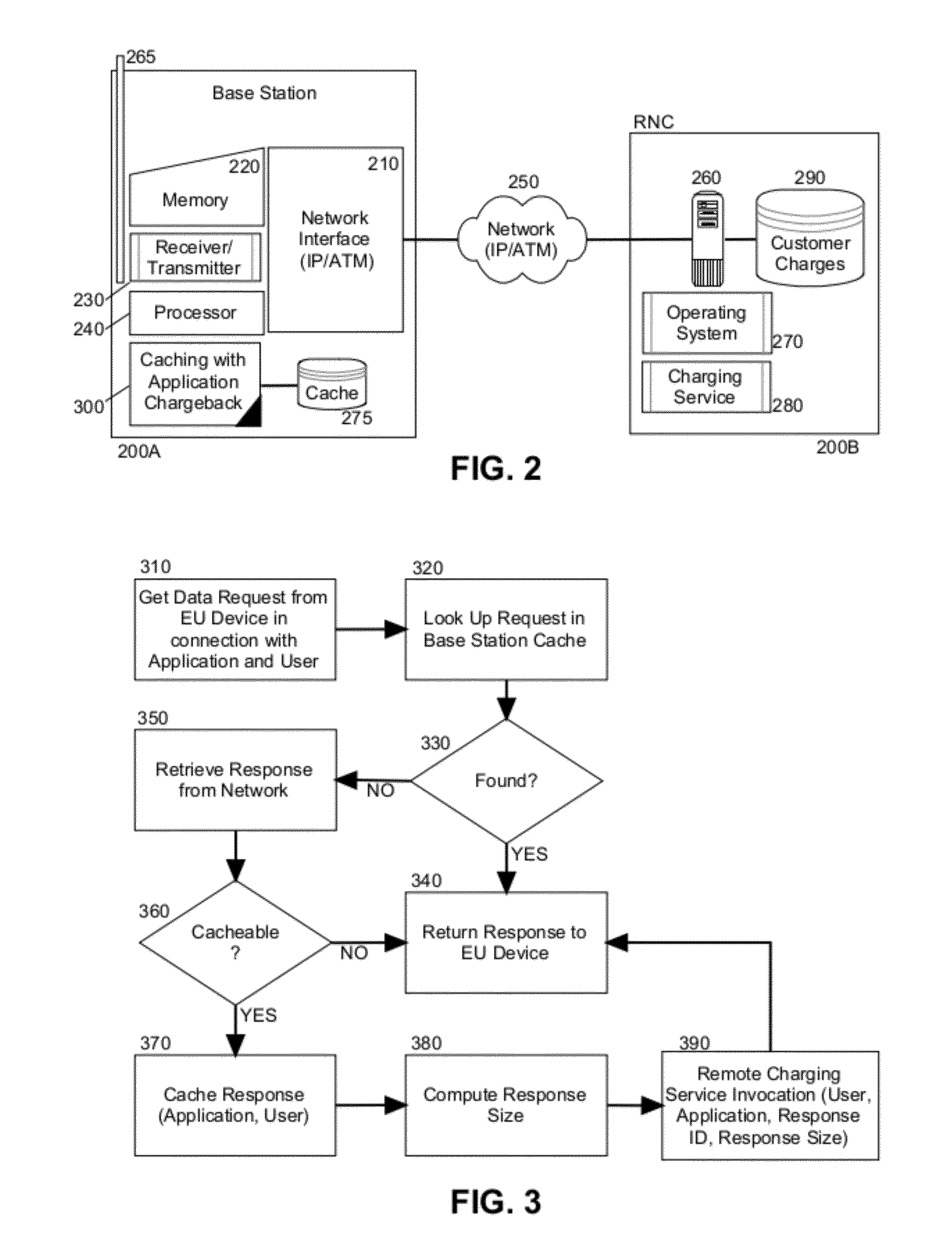

Application-specific chargeback of content cached at the wireless tower

ActiveUS20120099482A1Multiplex system selection arrangementsSpecial service provision for substationApplication specificTower

A method for application-specific chargeback of content cached at a wireless tower of a RAN includes receiving a request for content from an end user device in a base station of a RAN and routing the request to an application in a packet switched data communications network from the base station by way of a CN. Content from the application can be received in the base station within a response to the request, the response can be cached in a local cache of the base station in connection with the application and the response can be forwarded to the end user device. Subsequently, in response to a new request for the content received in the base station, the content can be served in a response from the local cache. Further, an identity of the application can be transmitted to a remote charging service external to the base station but within the RAN for charging the application in consequence of having served the content from the local cache of the base station.

Owner:IBM CORP

Upgrading of Recurring Payment Cancellation Services

A method of reducing chargebacks due to a cancelled recurring payment, wherein the payment occurs within a card-based financial network, and wherein the network includes a database of unauthorized recurring charges and a defined chargeback procedure. The method generally includes the step of upgrading a recurring payment cancellation services file based on predefined occurrences relating to the identifying of cancelled recurring payments.

Owner:MASTERCARD INT INC

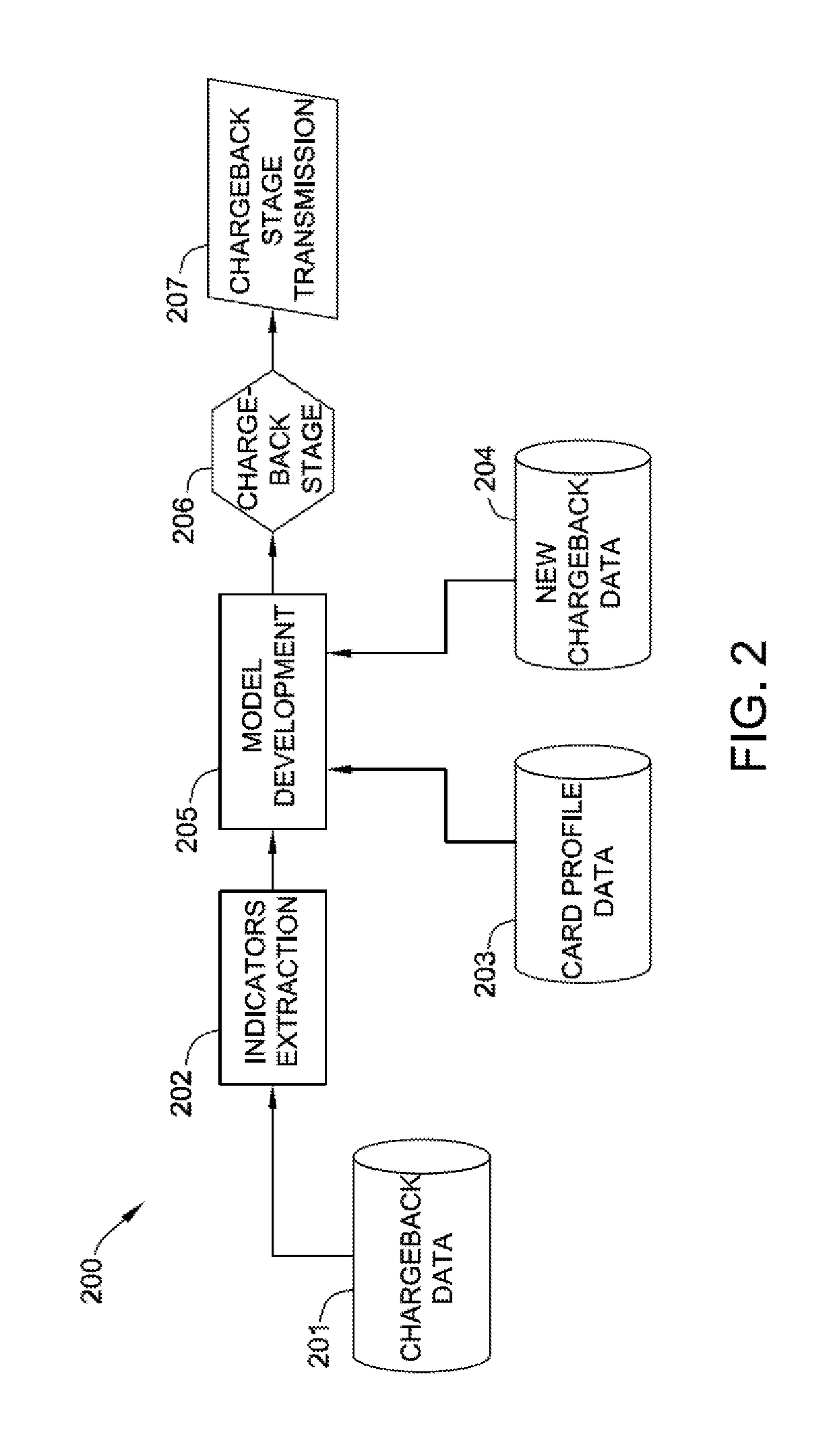

Systems and methods for predicting chargeback stages

A chargeback prediction computing device for predicting a chargeback stage for a payment transaction is provided. The chargeback prediction computing device is configured to store chargeback data from a plurality of chargebacks associated with a plurality of account holders wherein the chargeback data includes a plurality of variables, determine a set of indicators from the plurality of variables wherein the indicators include variables associated with each chargeback stage, generate a chargeback prediction model based on the set of indicators, receive candidate chargeback data for a candidate chargeback request wherein the candidate chargeback data includes a plurality of candidate variables, apply the chargeback prediction model to the candidate chargeback data to generate an output, and generate a chargeback type for the candidate chargeback request based on the output, wherein the chargeback type indicates a probability that the candidate chargeback request will reach a particular chargeback stage.

Owner:MASTERCARD INT INC

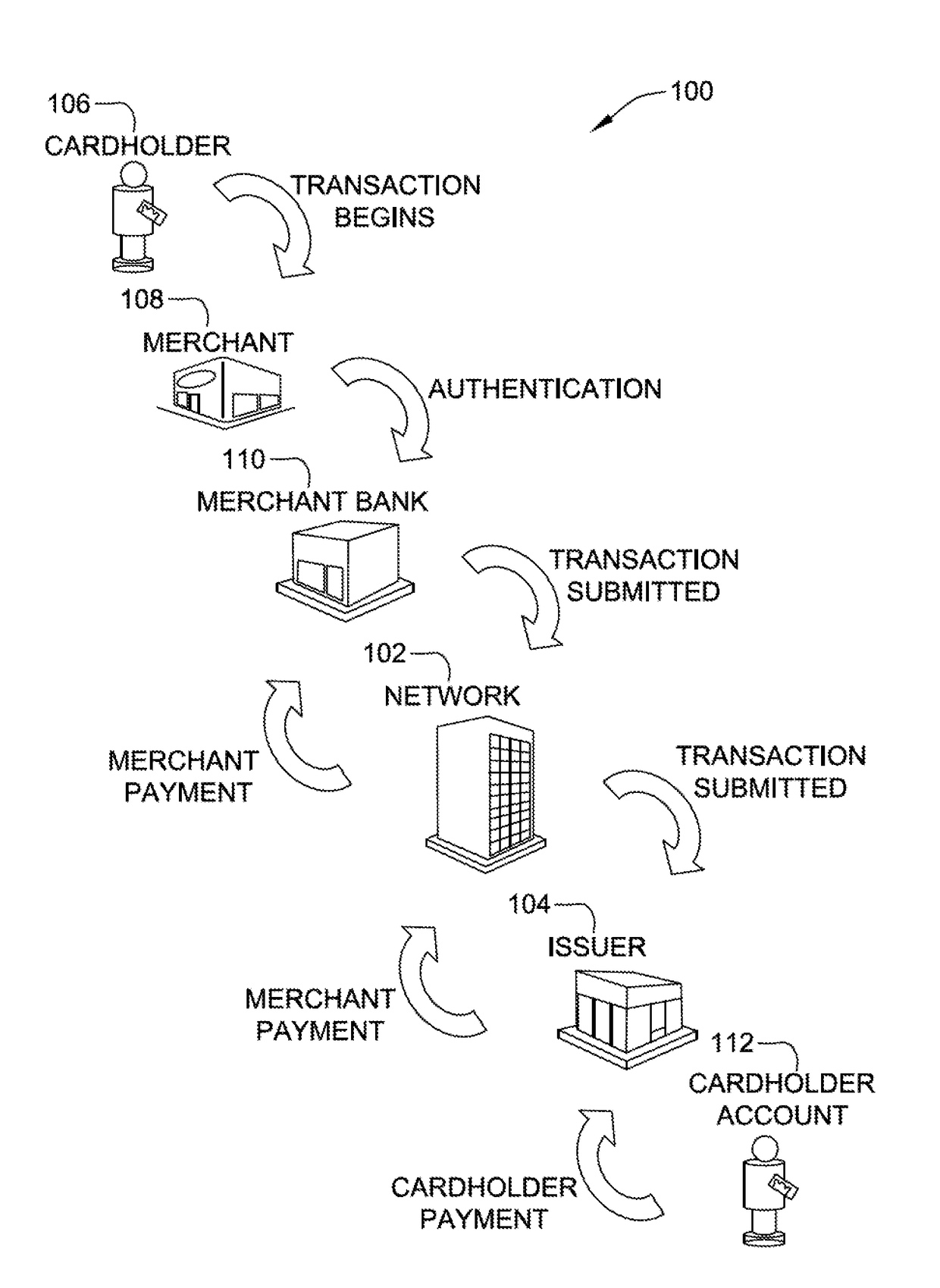

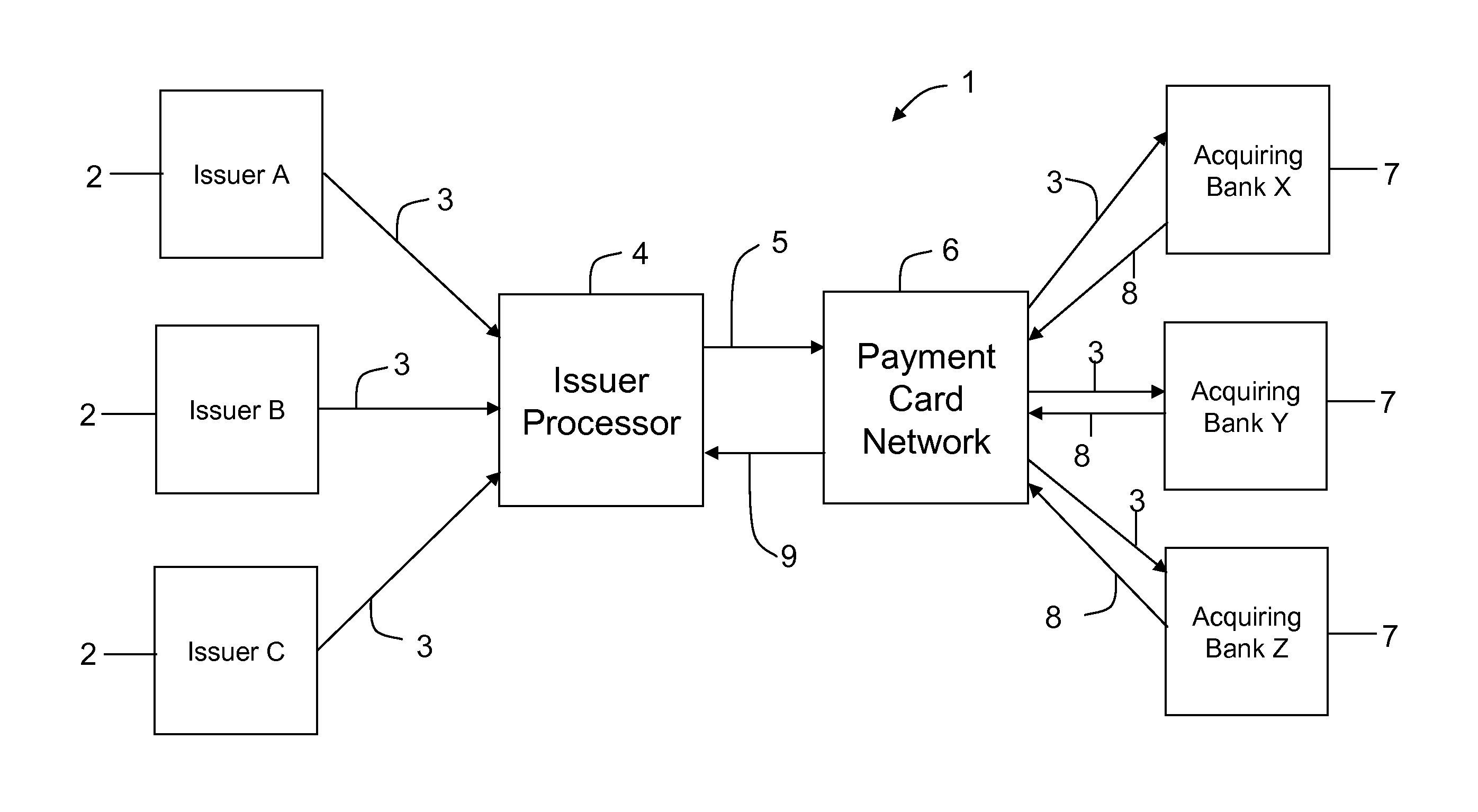

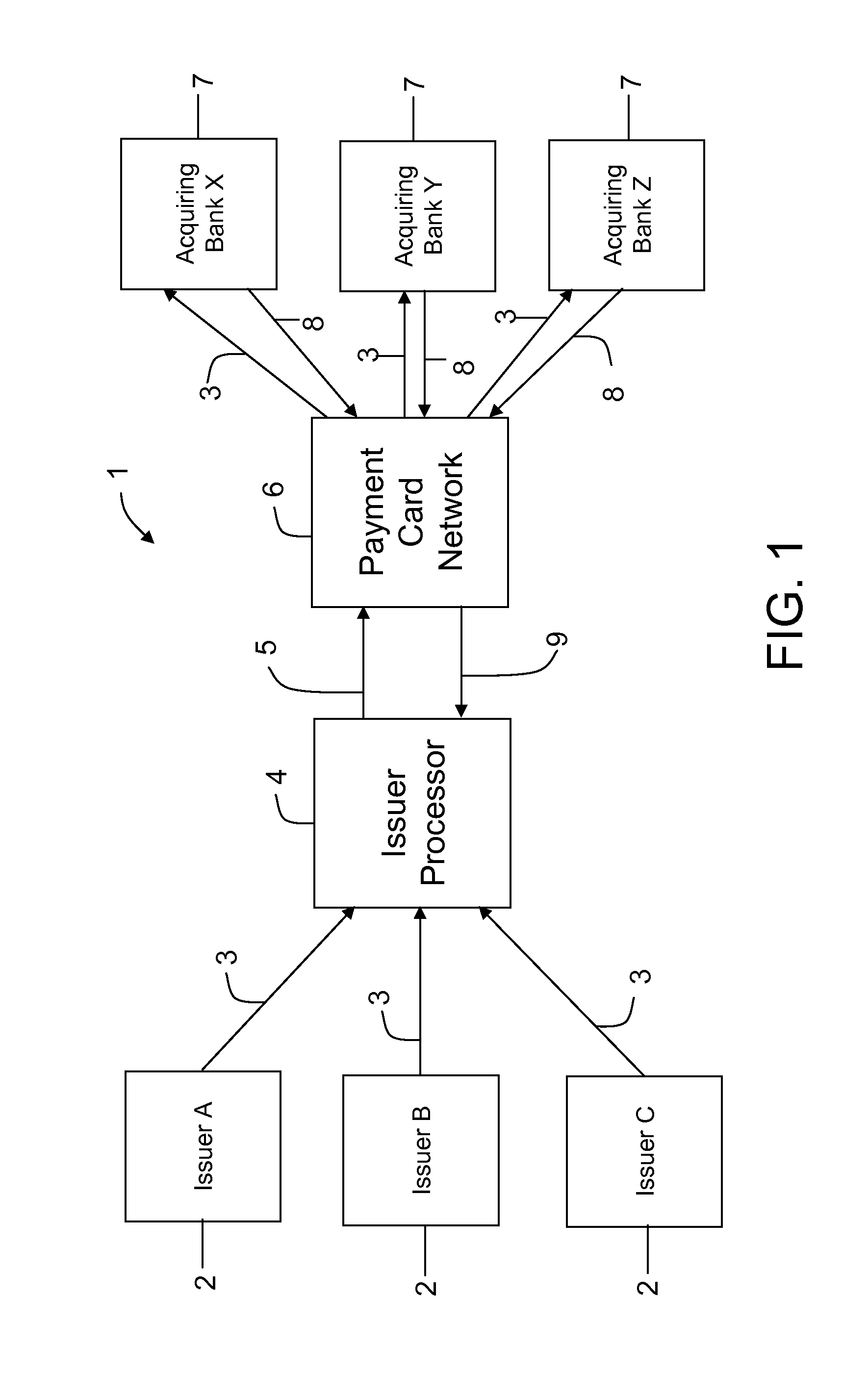

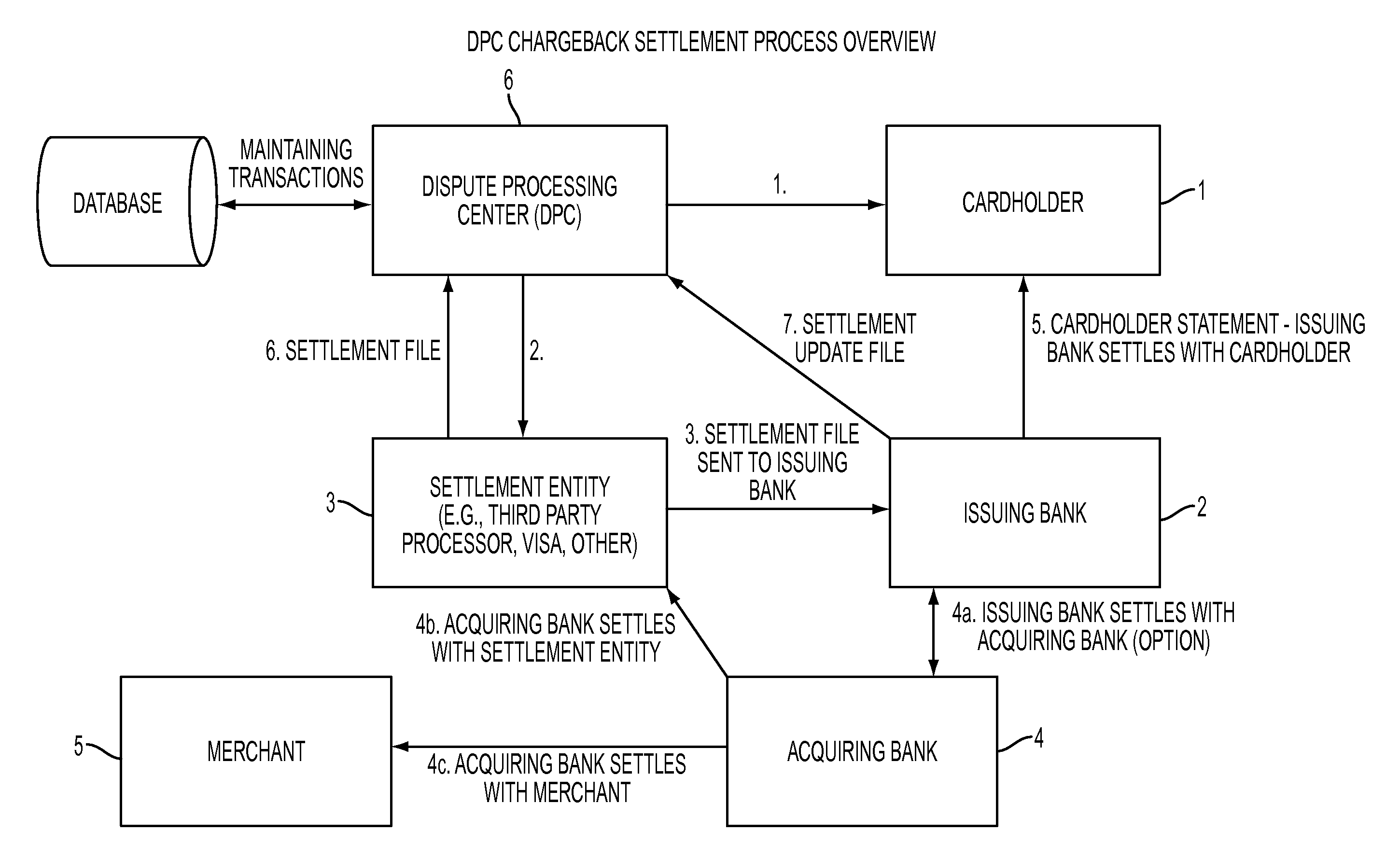

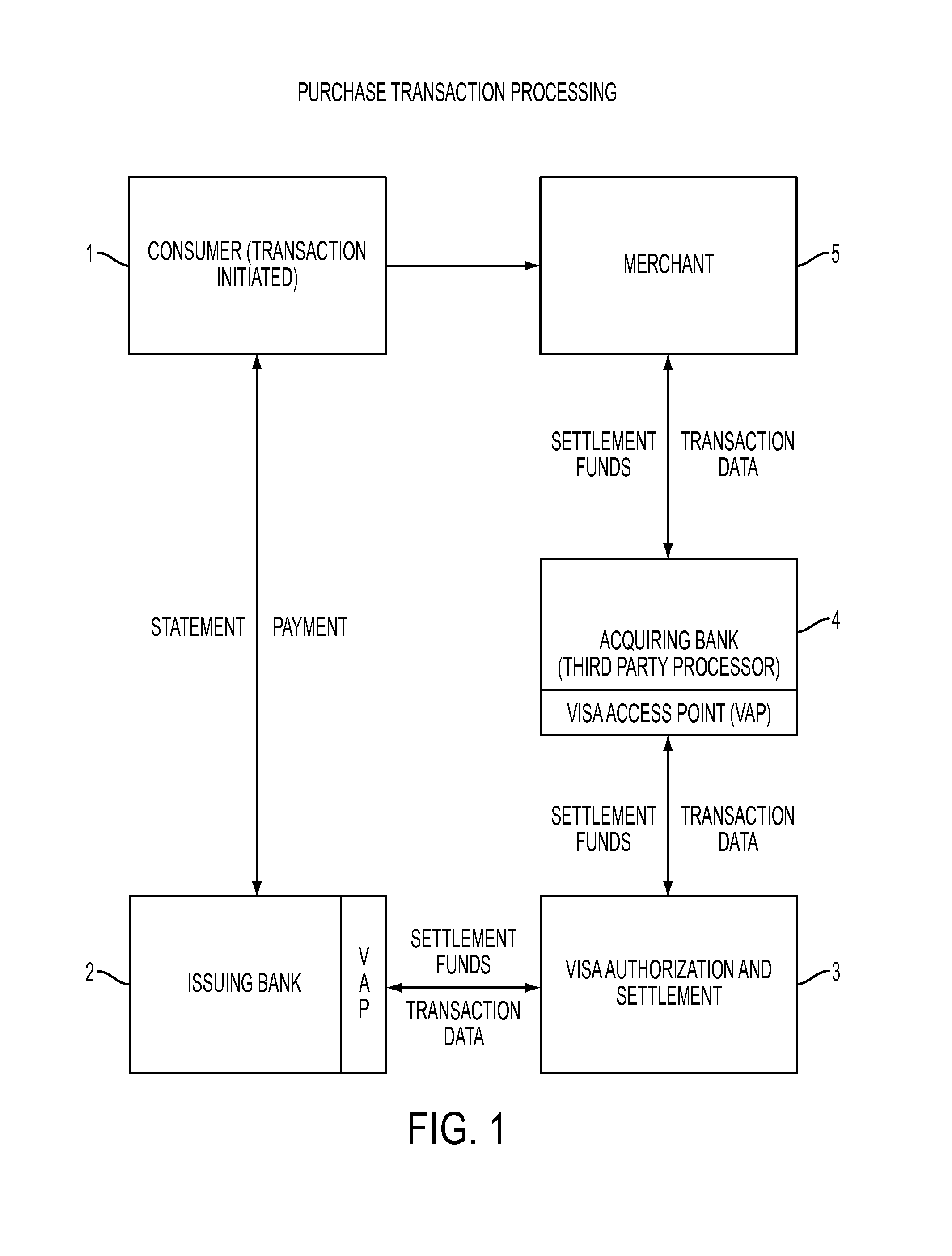

Systems and methods for settling chargeback transactions

A chargeback settlement processing (CSP) computer system for determining a gain or loss in a chargeback transaction is provided, that includes a memory device and a processor in communication with the memory device. The processor is programmed to transmit to a payment card network for settlement at least one chargeback transaction file corresponding to at least one received chargeback transaction, associated with an original transaction settled using a first currency exchange rate. The at least one chargeback transaction file includes a unique file identifier. A reconciliation message received from the payment card network includes at least one settlement amount, determined at a second currency exchange rate, for the at least one chargeback transaction and the unique file identifier. The at least one chargeback transaction file is matched to the at least one settlement amount, using the unique file identifier, to determine whether a net gain or a net loss occurred.

Owner:MASTERCARD INT INC

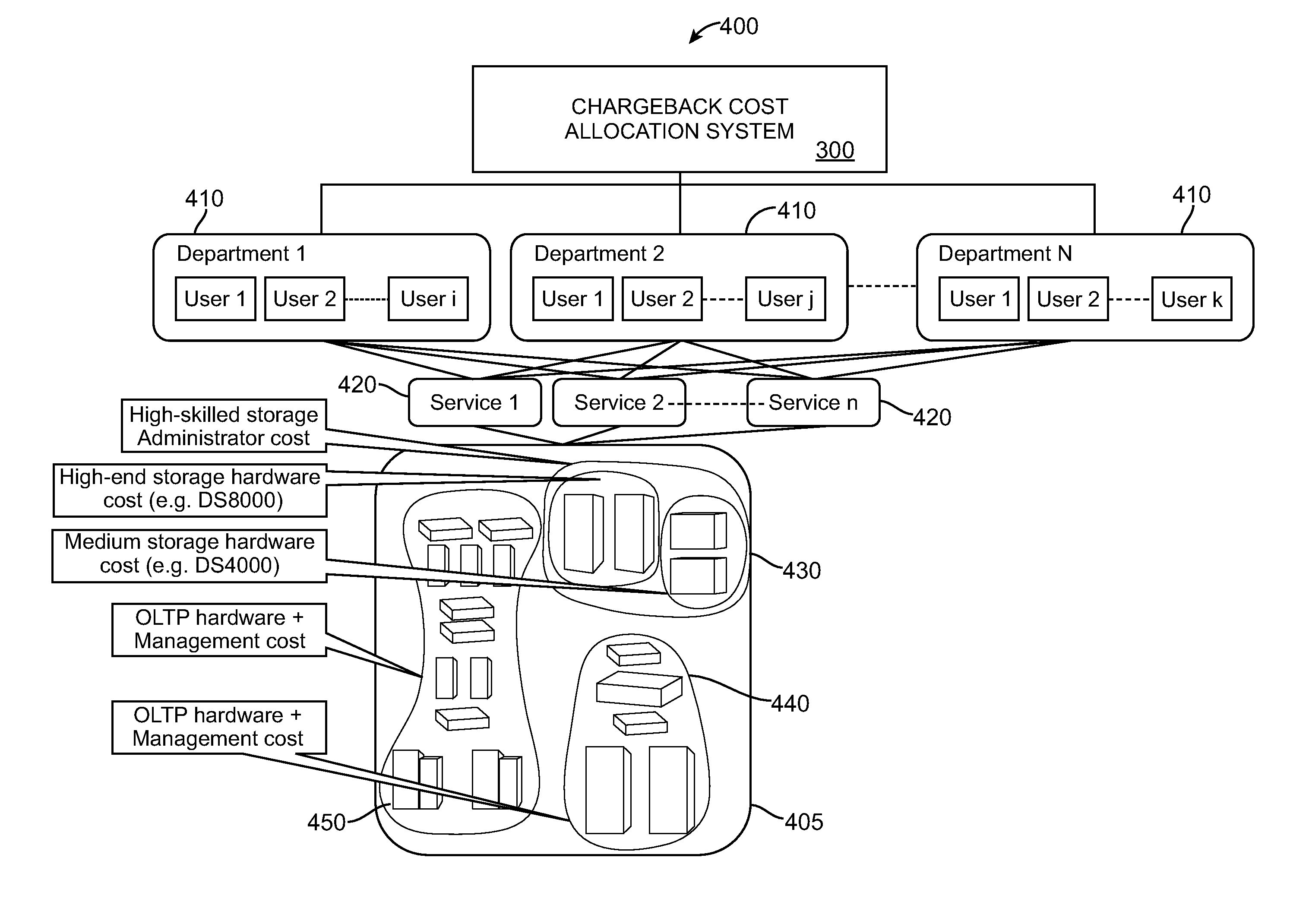

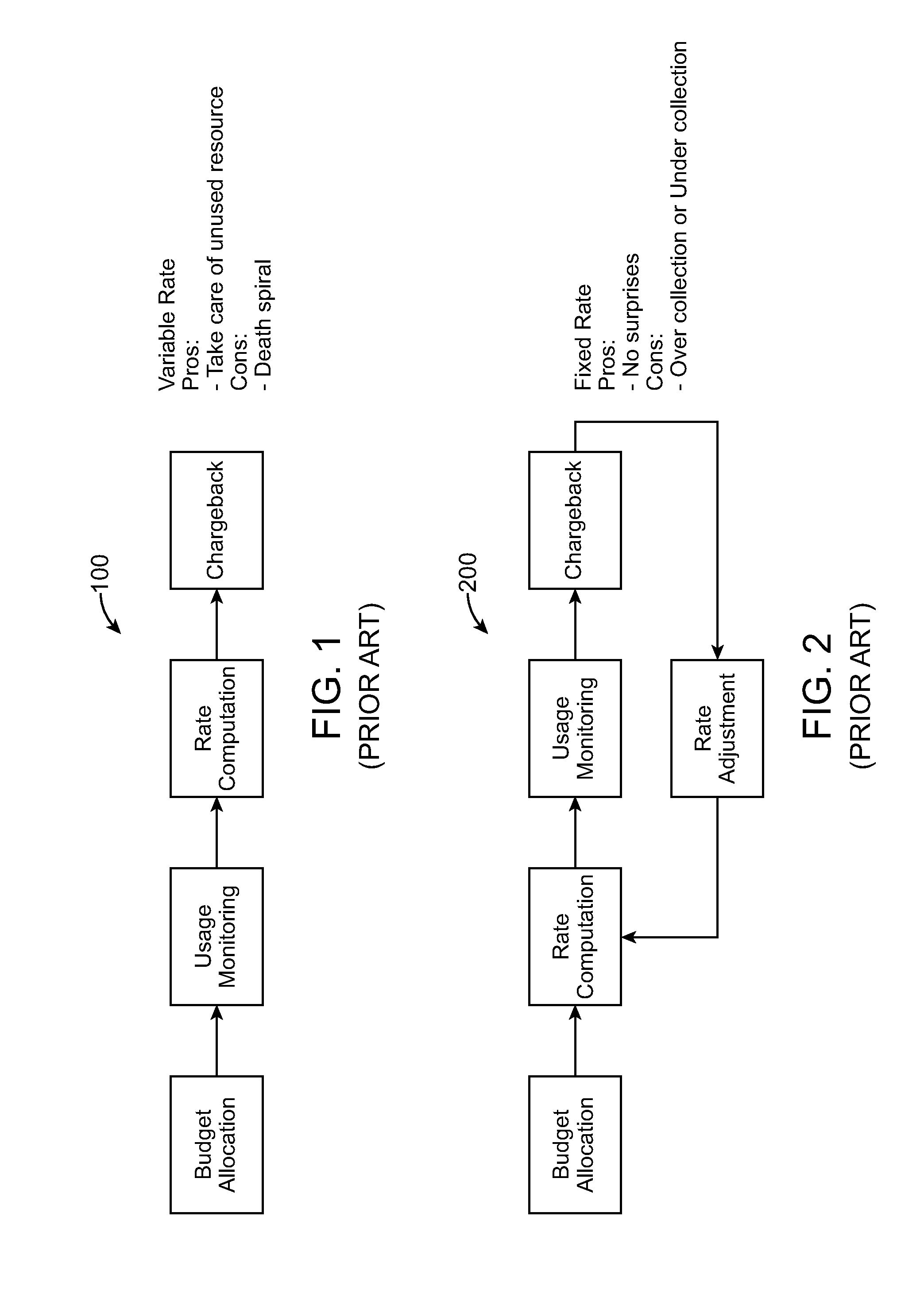

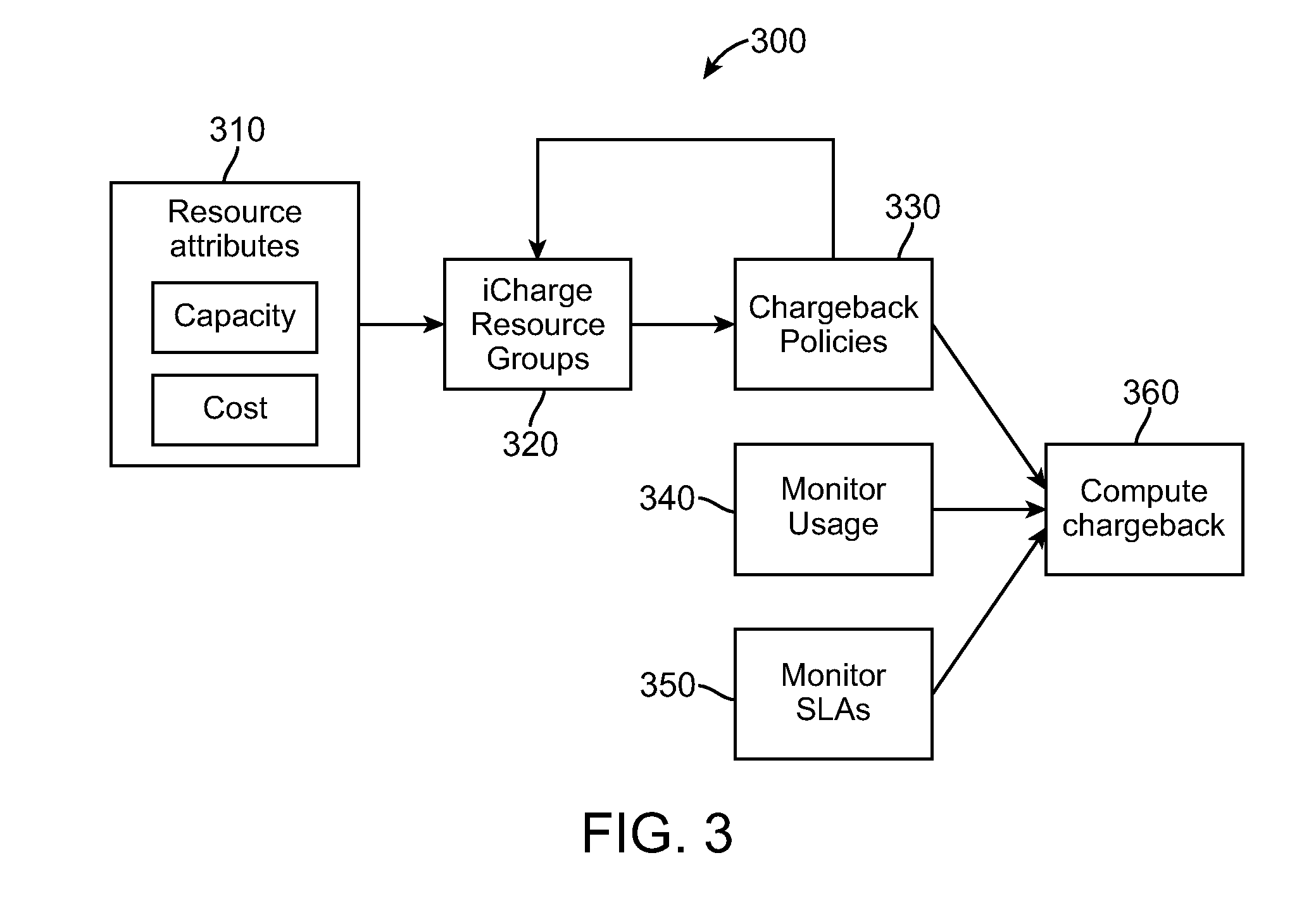

Method and system for chargeback allocation in information technology systems

The invention provides a system and method for chargeback cost allocation in an information technology (IT) system including multiple resources. The method includes categorizing cost attributes of different resources into multiple levels defining a cost attribute hierarchy, defining different chargeback groups for resources with similar cost attributes and chargeback policies at different levels of the hierarchy, and performing chargeback cost allocation by allocating the cost for resources at each hierarchy level independently using chargeback policies defined for the resources at that hierarchy level.

Owner:RAKUTEN GRP INC

System and method for secured communications between a mobile device and a server

Owner:STICKY IO INC

Process and system for providing automated responses for transaction operations

Various systems for managing chargeback, retrieval, and other requests from the card associations, issuing banks, merchant banks, or other financial institutions requiring a merchant's response are disclosed herein. Such systems may include various forms of hardware, software and manual processes intended to: (a) retrieve transaction requests; (b) retrieve merchant's transaction data; (c) gather merchant's data and compile with normalized transaction request data; (d) create response cases; (e) provide merchant notifications; and (f) transmit responses to requestors. With the present invention, these often independent and incompatible processes, including their non-standard data formats, are normalized and compiled into compatible formats that integrate and facilitate the automation of substantially all aspects of a given chargeback process in one embodiment.

Owner:SIGNATURELINK

Method and apparatus for processing a cardholder's inquiry or dispute about a credit/charge card

A method and system for processing a credit request from a credit / charge cardholder which automatically applies a rules-based decision process to determine whether to credit the cardholder's account, the amount of the credit, whether to do a chargeback to the merchant, and the amount of the chargeback. Individual issuing banks who issue credit / charge cards and individual merchants may specify custom rules which must be considered before a credit is issued and / or before a chargeback to the merchant is performed. The rules set forth the conditions under which the merchant will waive its right to prove the disputed transaction such that a chargeback is automatically issued to the merchant. For example, a merchant may specify that if the transaction is $20 or less, it will accept an automatic chargeback without the merchant's involvement and if the transaction is greater than $20, the merchant wants to receive notice of the dispute and the opportunity to prove or verify the authenticity of the transaction. In one aspect, the system may optionally include the blocking of calls based upon a list of potential callers from whom further transactions or requests for chargeback will be declined. The callers ANI or calling number identification is compared against the list, and the calls are not answered by the system.

Owner:WEST TELESERVICES CORP

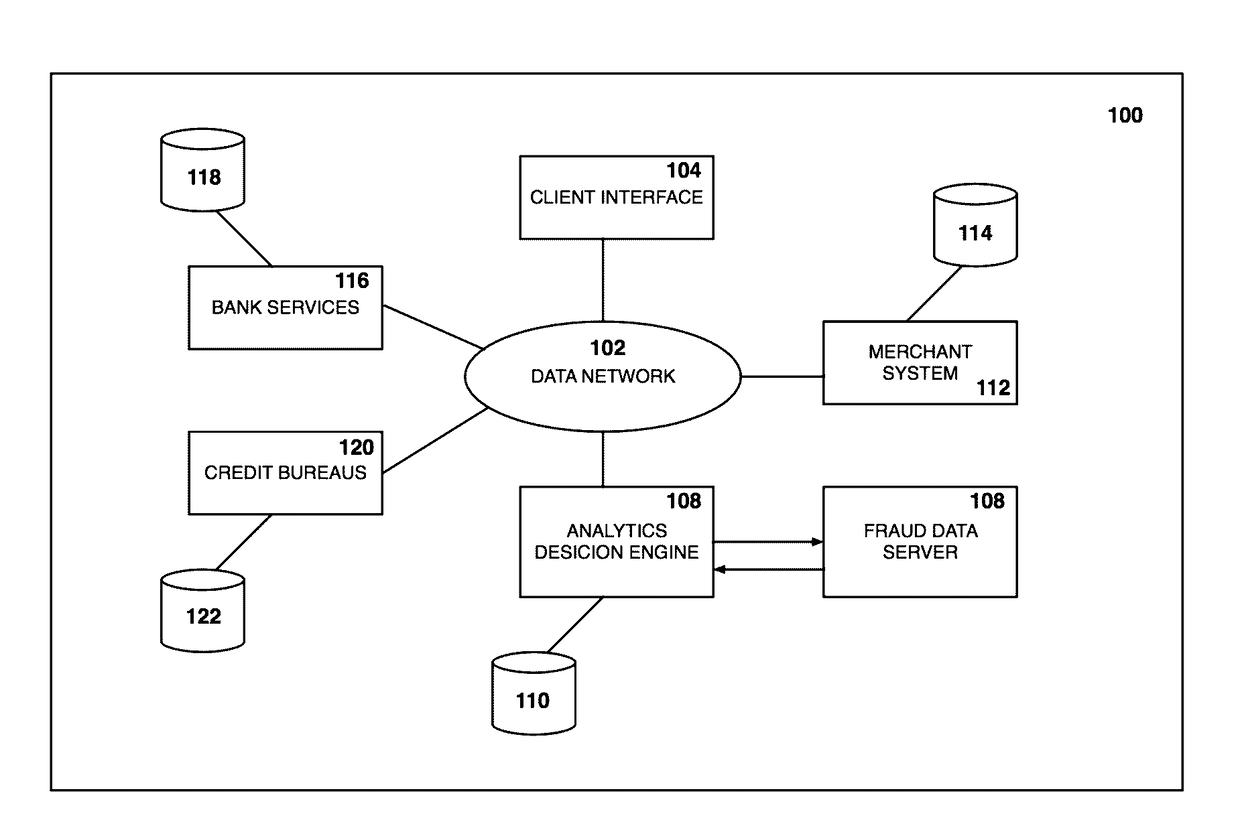

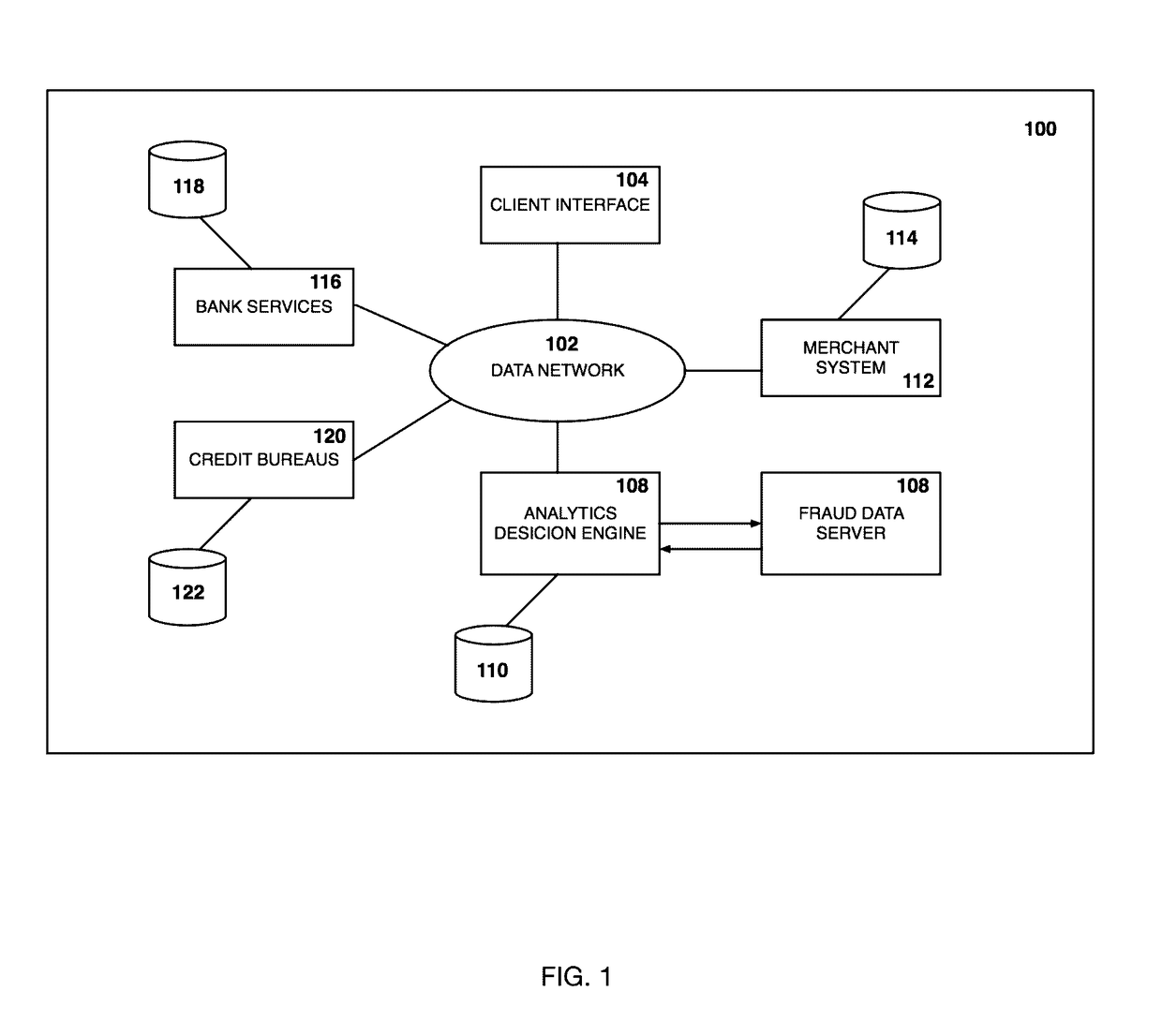

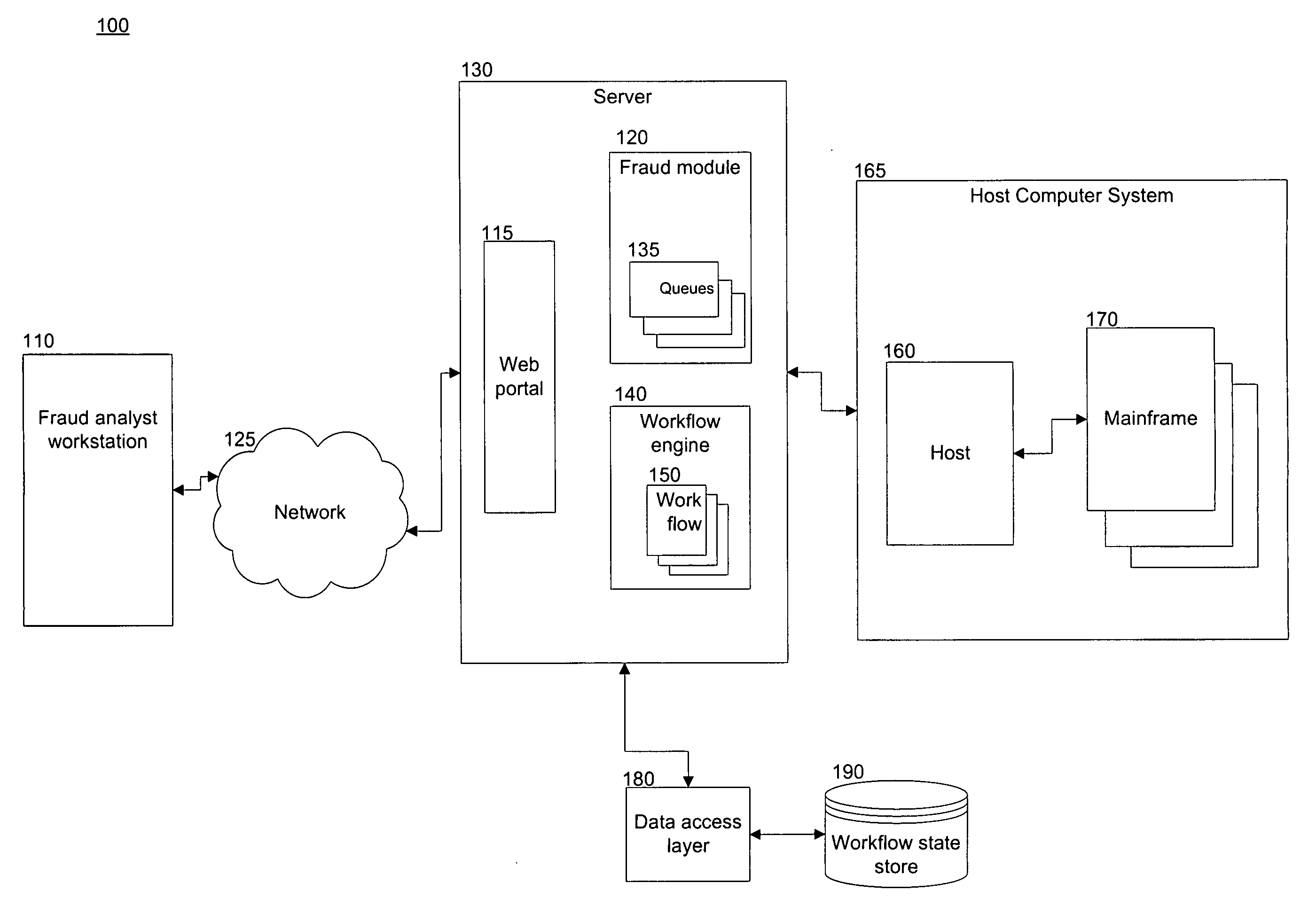

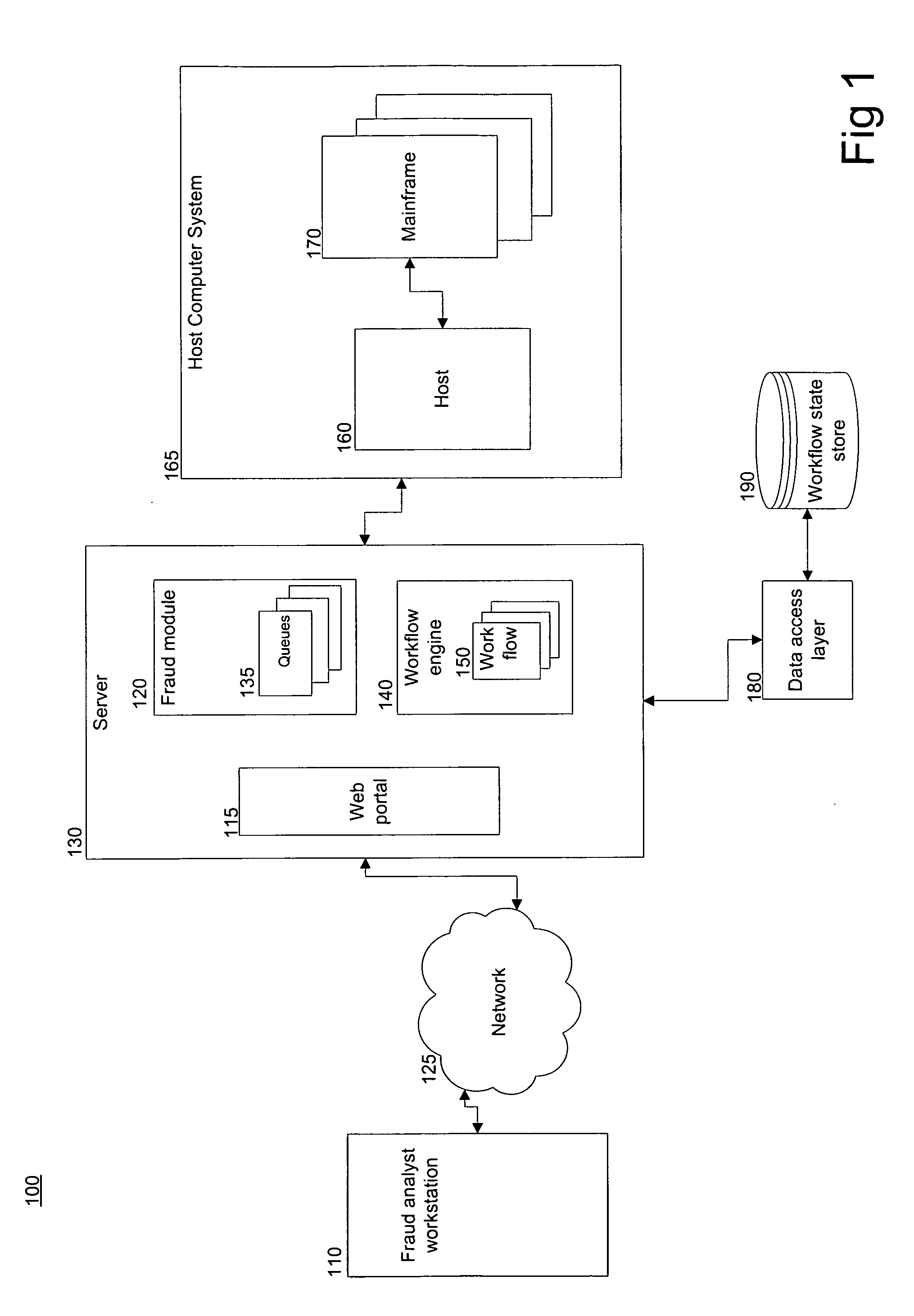

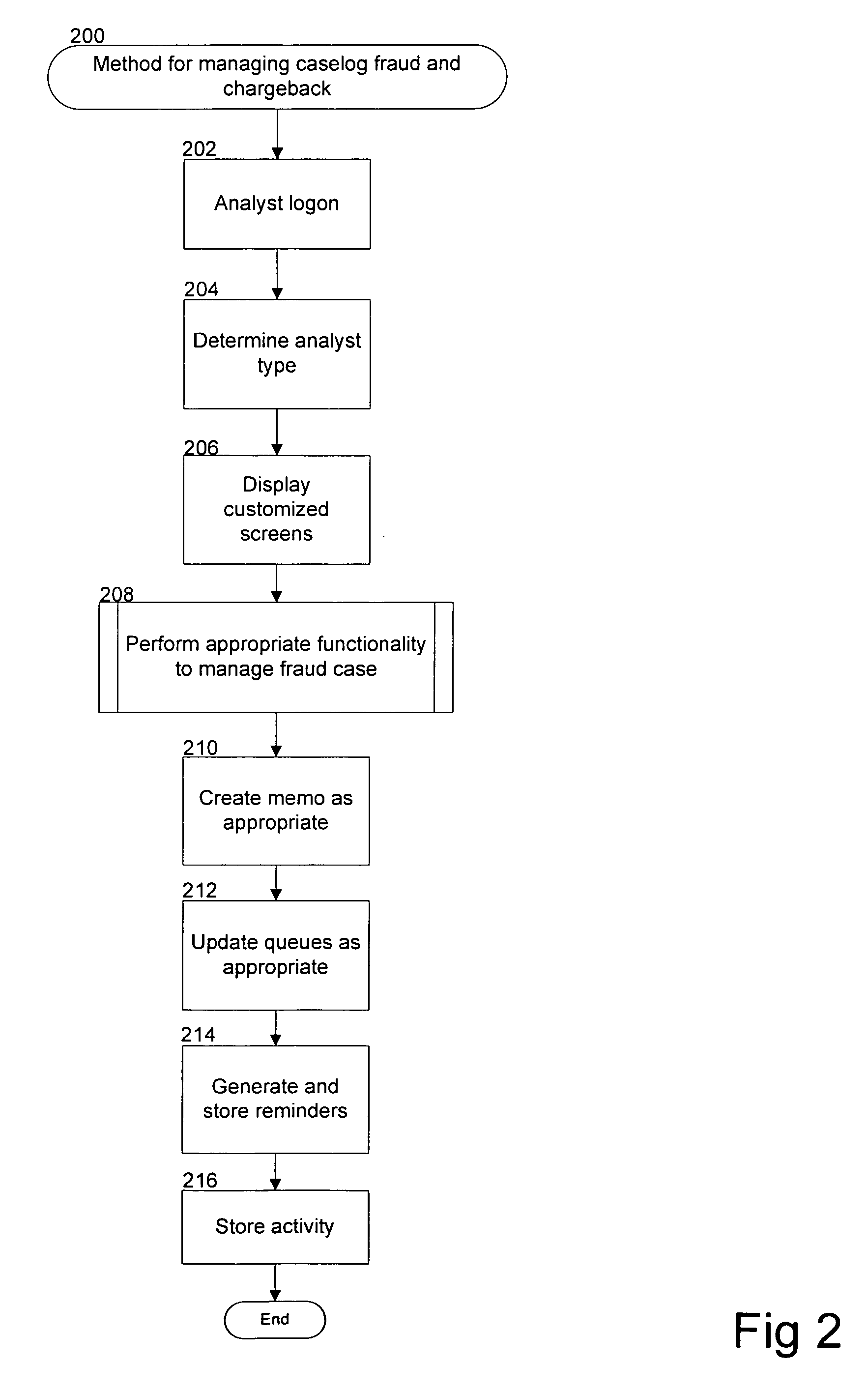

Method and system for managing caselog fraud and chargeback

Managing caselog fraud and chargeback. The systems and methods include the ability to manage a fraud case in a fraud queue; automatically locate the data associated with the fraud case; display workflows on a customized graphical user interface; automatically navigate through workflows that are based on predetermined rules specific to an account-provider, business, or regulation; store activity and data related to each fraud case; and automatically update the fraud queue. The systems and methods include a fraud analyst workstation, a workflow engine, a host computer system, and a workflow database. The fraud analyst workstation communicates with the workflow engine, which stores and the workflows. The workflow engine communicates with the host computer system to access data associated with the fraud case. The workflow engine communicates with a workflow database, which stores activity and data related to each fraud case for purposes of tracking, billing, and research.

Owner:TOTAL SYST SERVICES

Communication network and method for processing pre-chargeback disputes

InactiveUS20170330196A1Credit schemesBuying/selling/leasing transactionsTransaction dataCommunication link

A pre-chargeback computer network for processing pre-chargeback dispute messages includes a dispute analyzer (DA) computing device. The DA computing device is configured to receive a dispute message identifying a disputed transaction from an issuer portal over a first communication link, the dispute message including transaction data associated with the disputed transaction and dispute data. The DA computing device is further configured to analyze the transaction data and the dispute data, and route the dispute message over the pre-chargeback network or a separate chargeback network based on the analysis.

Owner:MASTERCARD INT INC

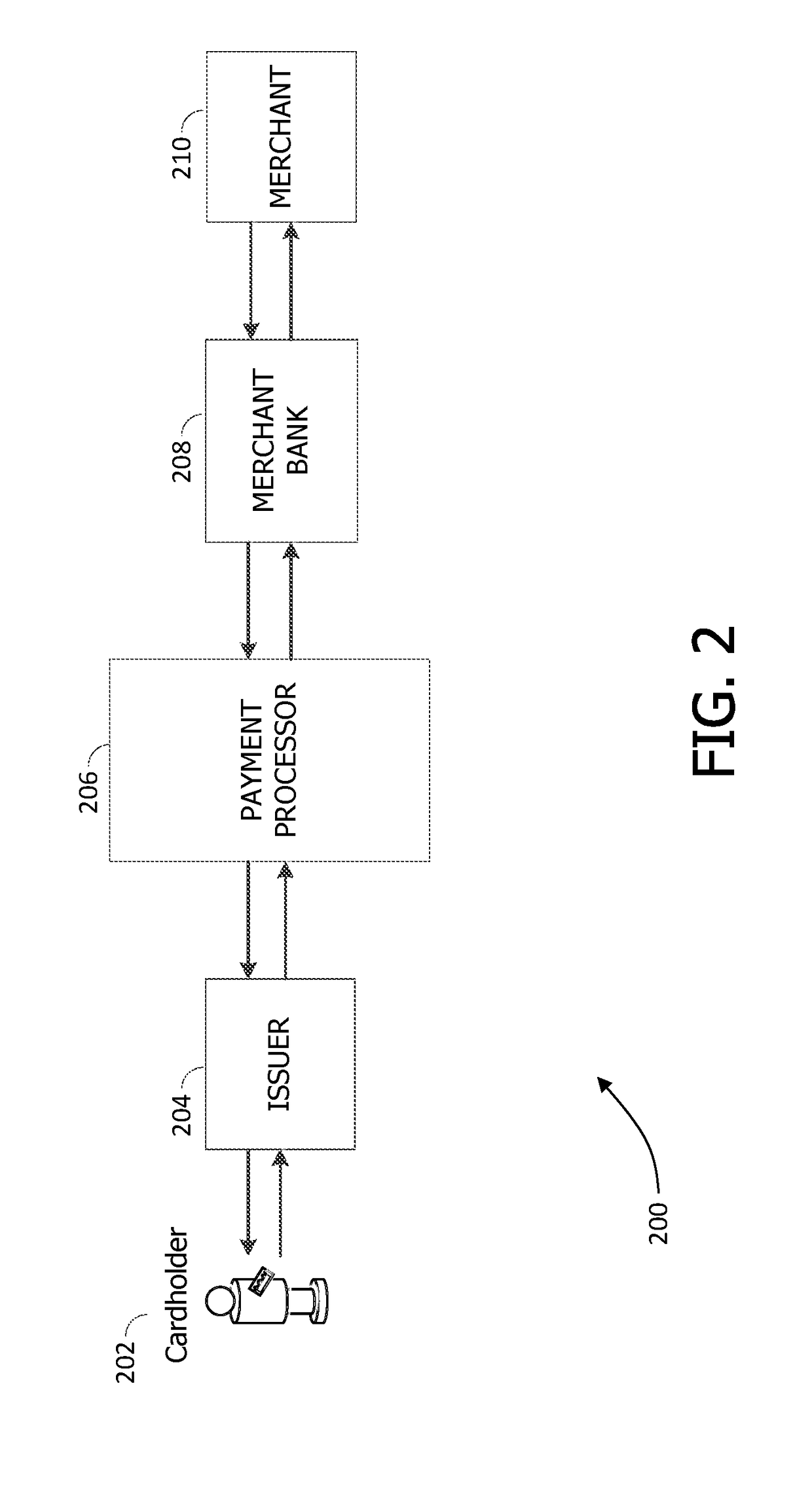

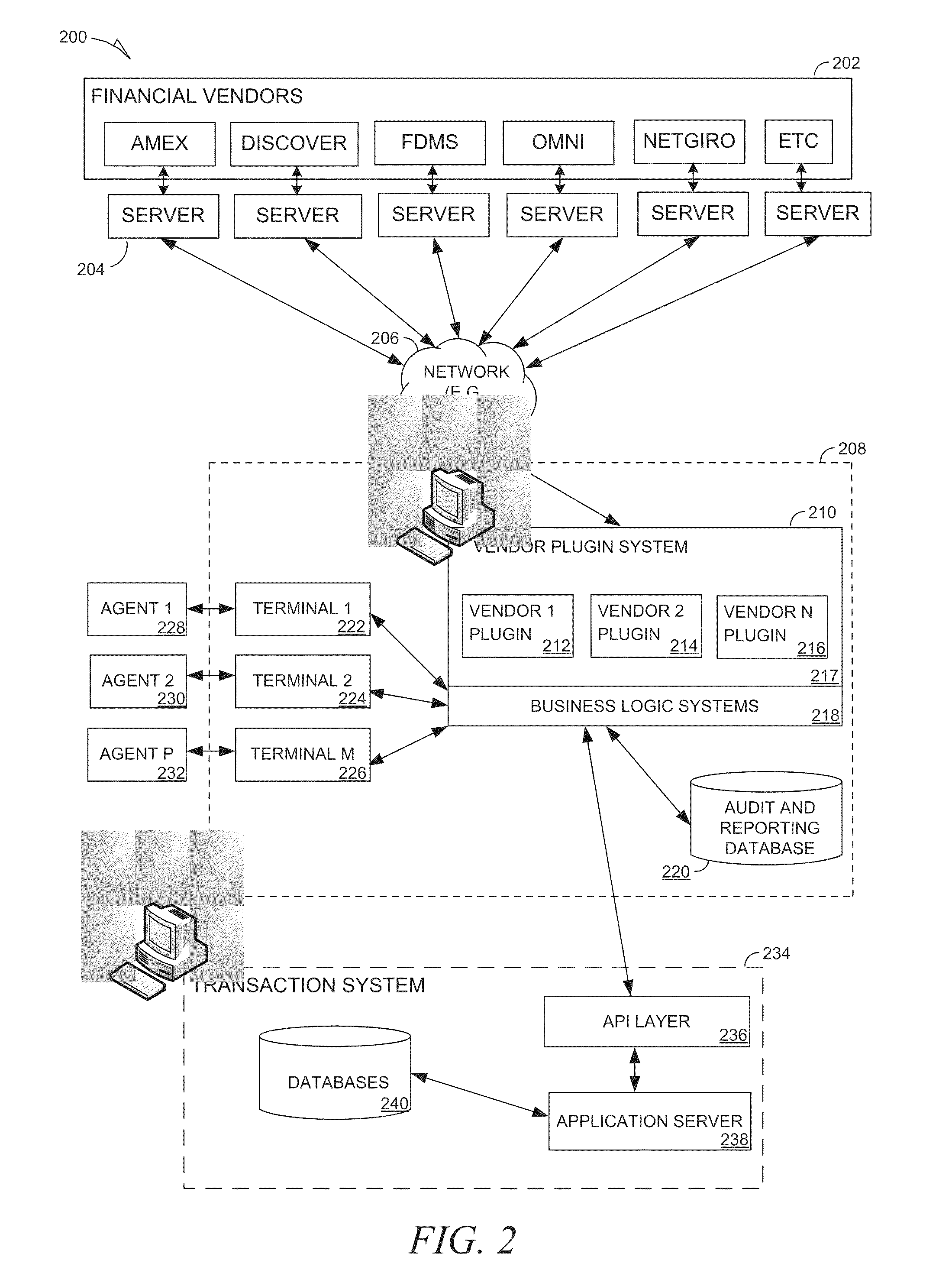

Chargeback response tool

A method and a system of a chargeback response tool. A chargeback response tool receives chargeback data from a financial vendor and automatically retrieves chargeback dispute evidence relating to the parties involved in the chargeback and about the original transaction from a transaction system that facilitated the original transaction. The chargeback response tool organizes and presents chargeback dispute evidence. The chargeback response tool may also analyze the performance and effectiveness of agents using the tool and of various approaches of disputing chargebacks.

Owner:PAYPAL INC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com