Patents

Literature

491 results about "Credit limit" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A credit limit is the maximum amount of credit that a financial institution or other lender will extend to a debtor for a particular line of credit (sometimes called a credit line, line of credit, or a tradeline).

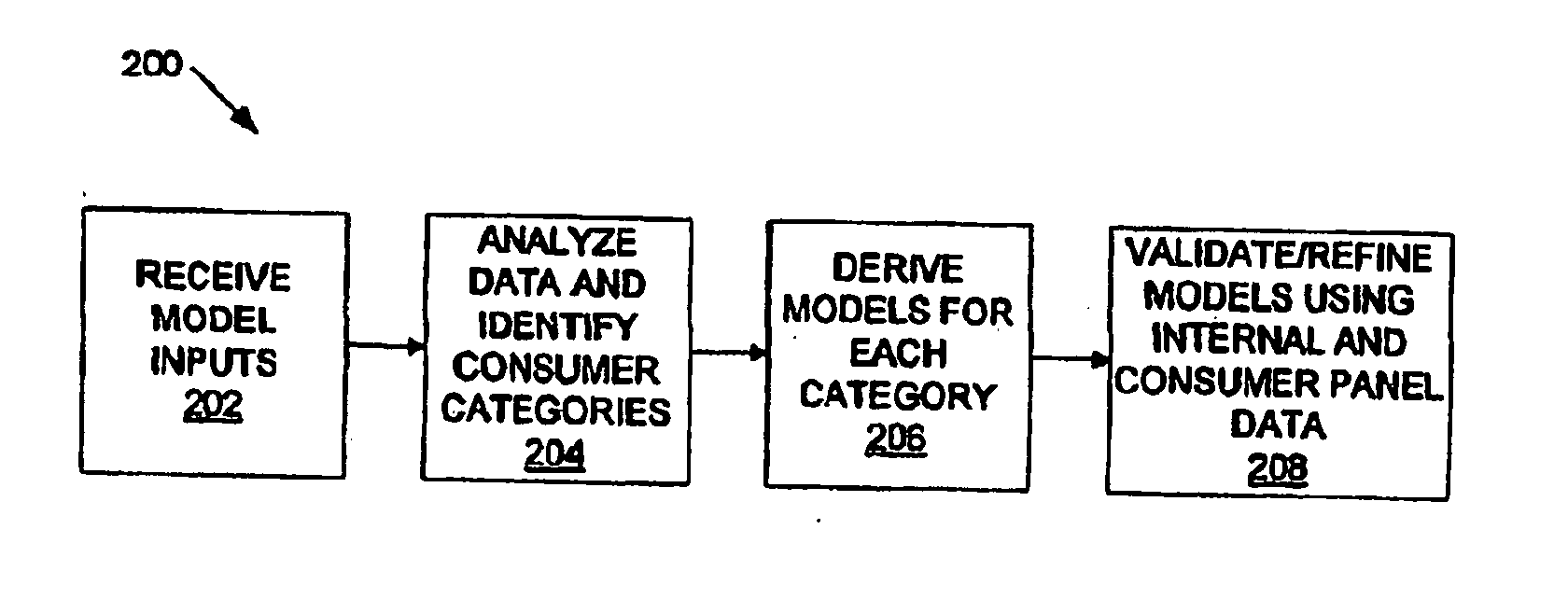

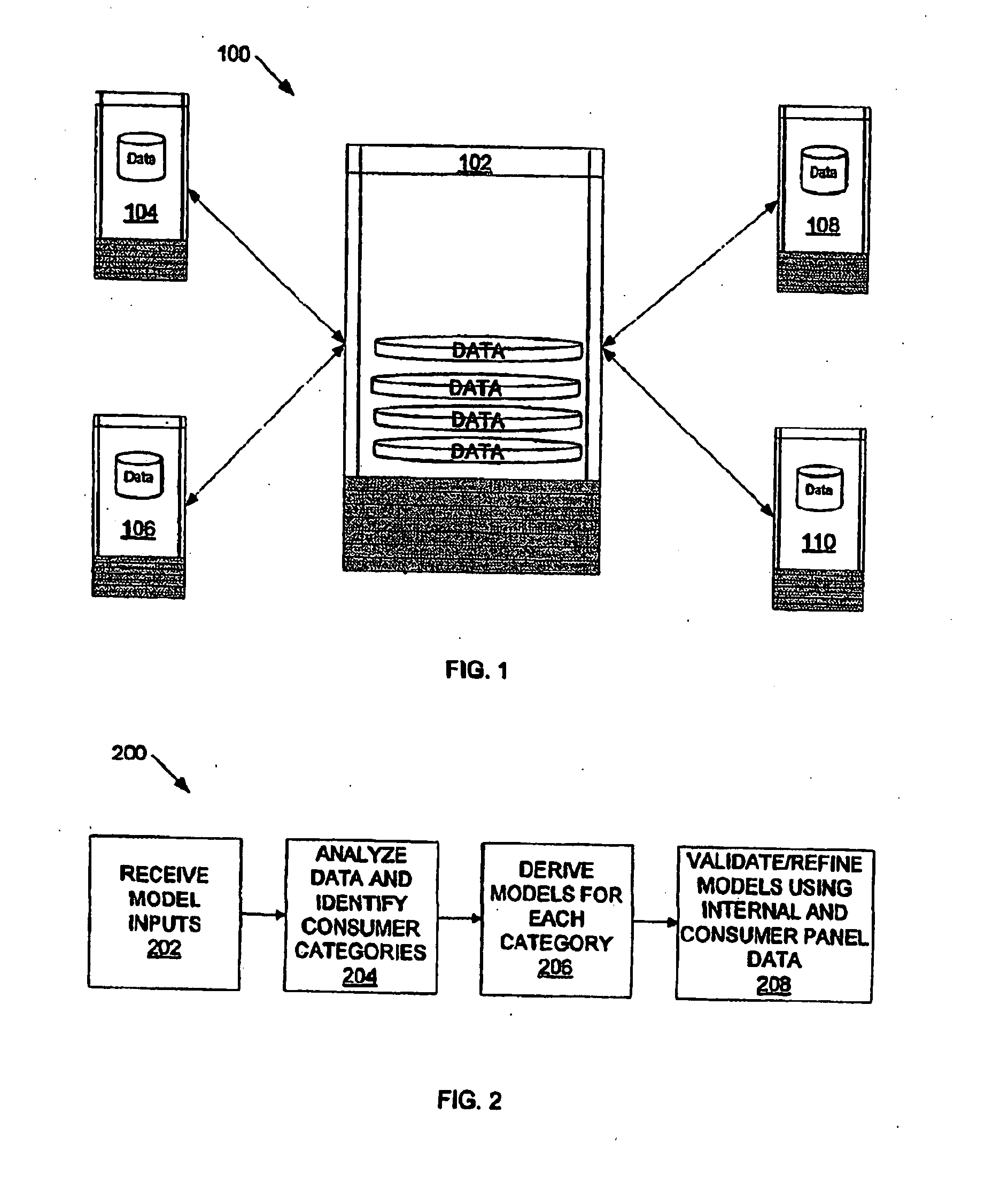

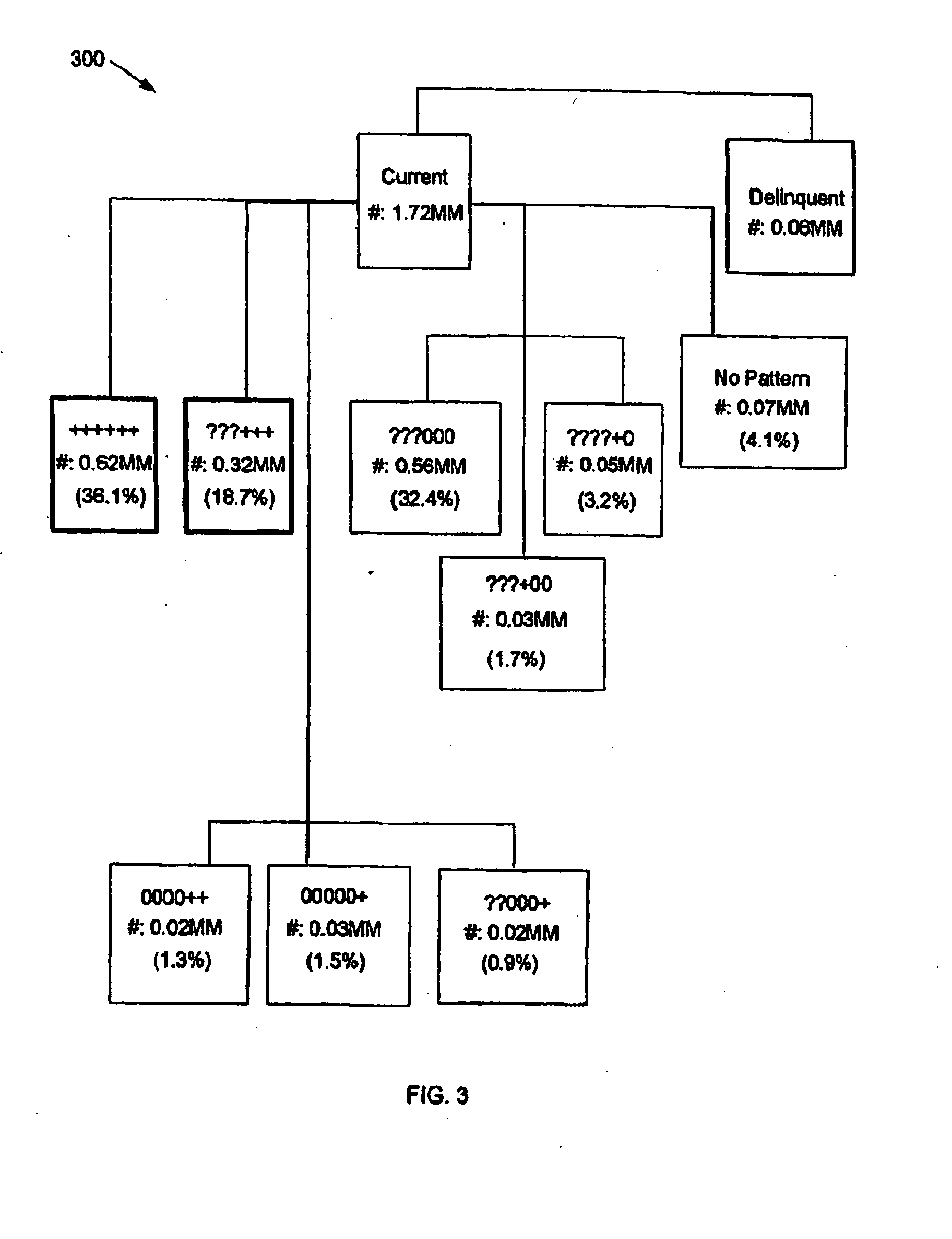

Method and apparatus for determining credit characteristics of a consumer

Share of Wallet (“SOW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumers spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. The outputs include the size of the consumer's spending wallet over a particular time period, the total number of the consumer's revolving cards, the consumer's revolving balance, the consumer's average pay-down percentage for revolving cards, total number of the consumer's transacting cards, the consumer's transacting balance, a number of balance transfers transacted by the consumer, the total amount of the consumer's balance transfers, the consumer's maximum revolving balance, the consumer's maximum transacting balance, the consumer's credit limit, size of the consumer's revolving spending, and the size of the consumer's transacting spending.

Owner:EXPERIAN MARKETING SOLUTIONS

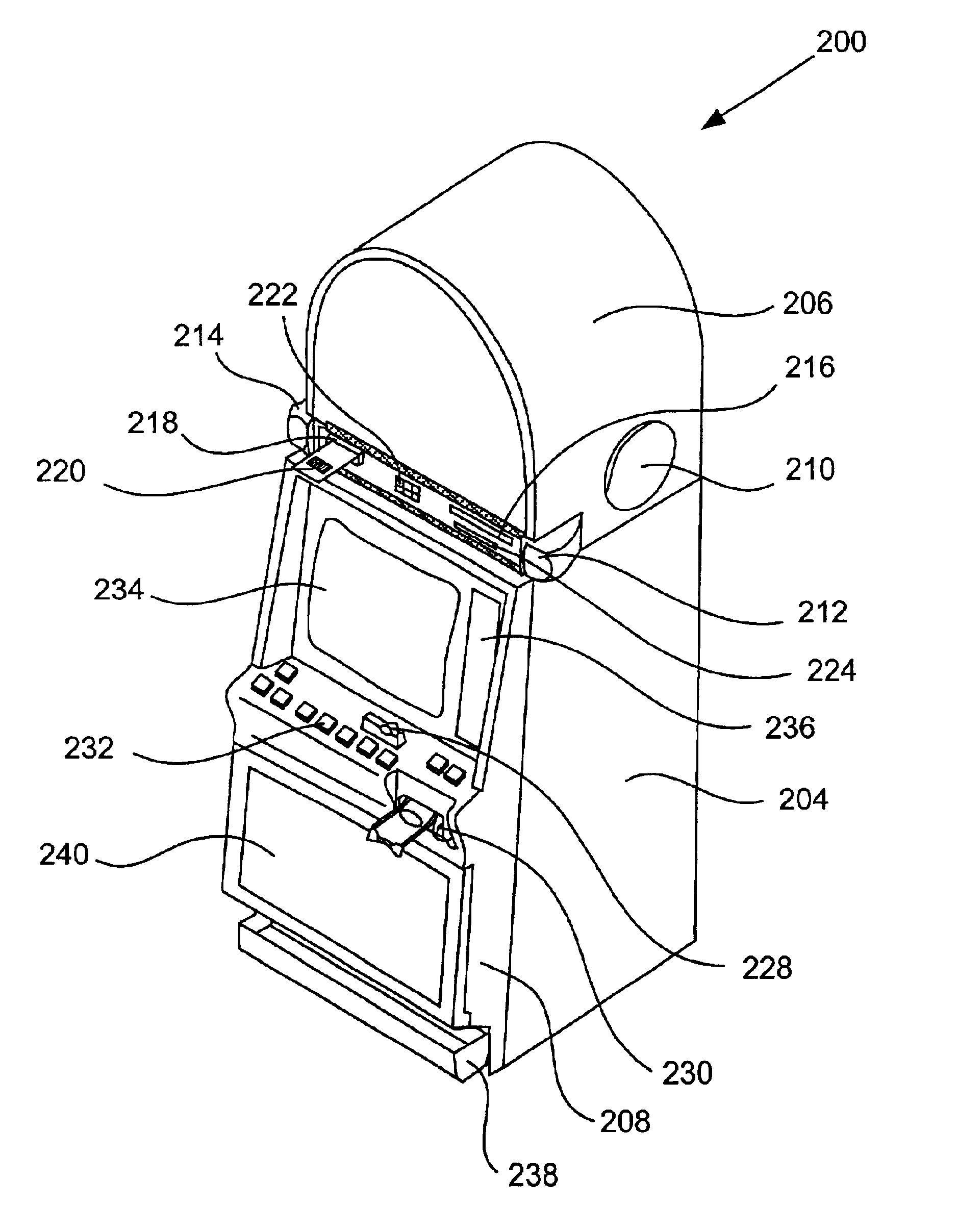

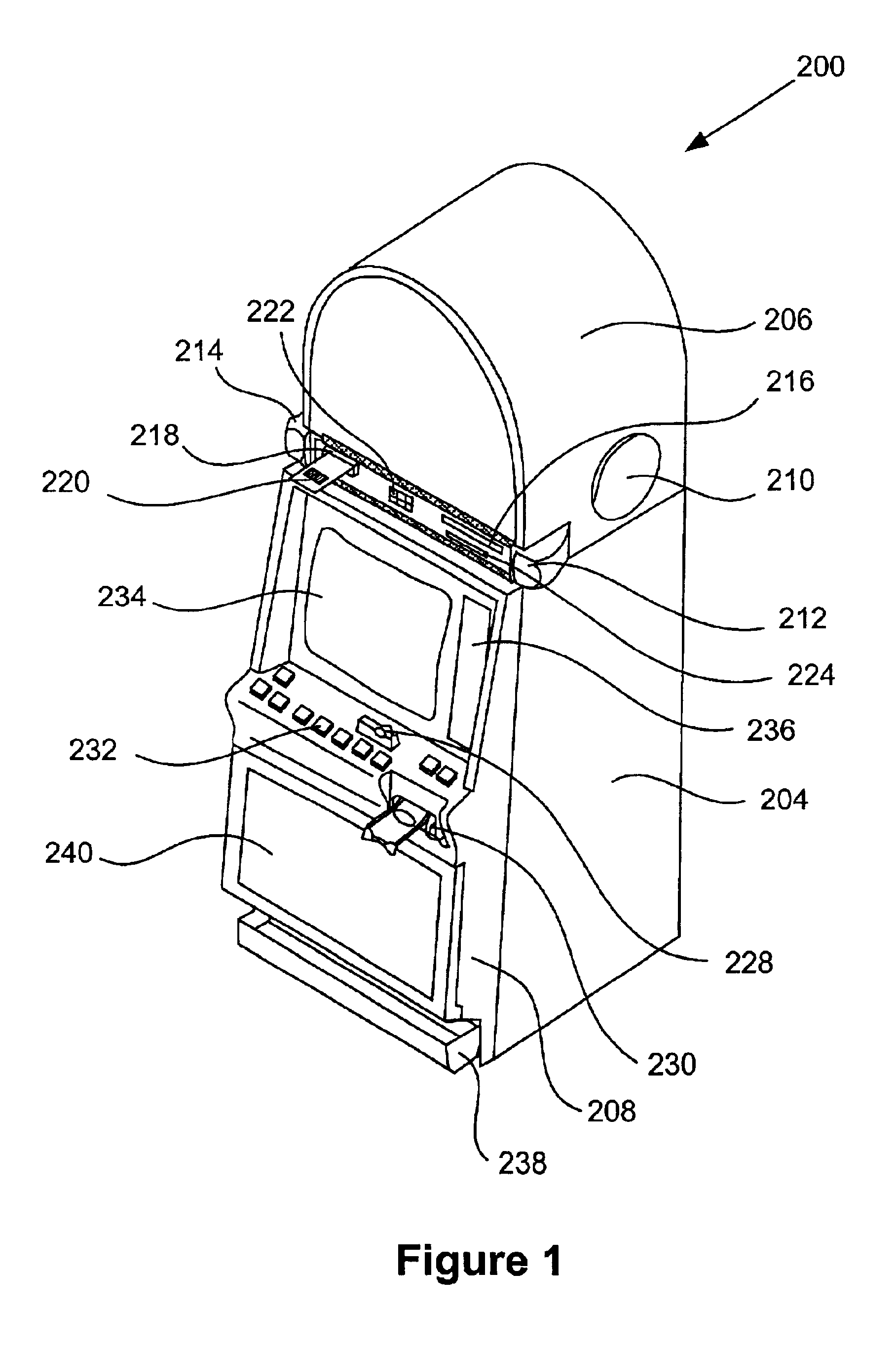

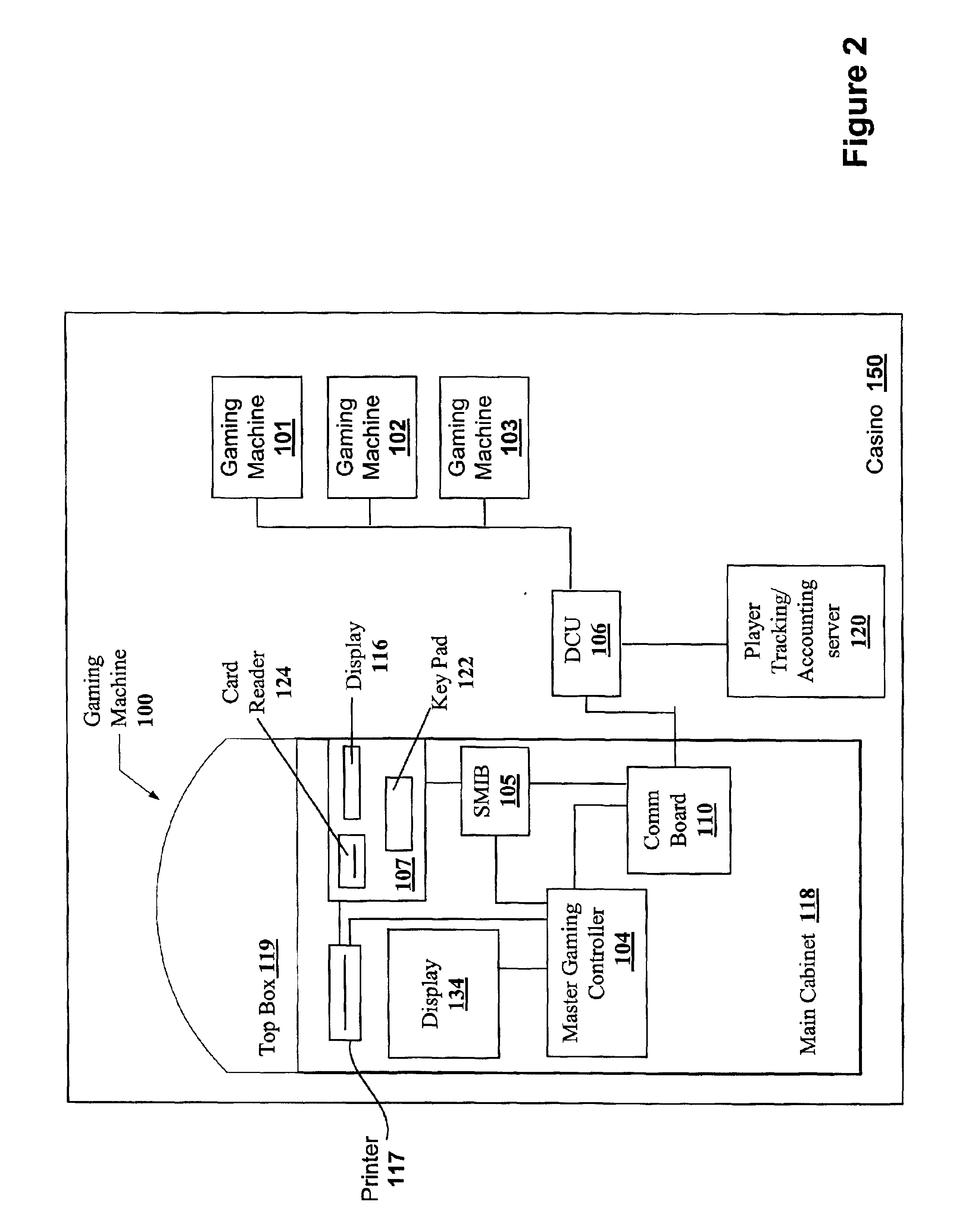

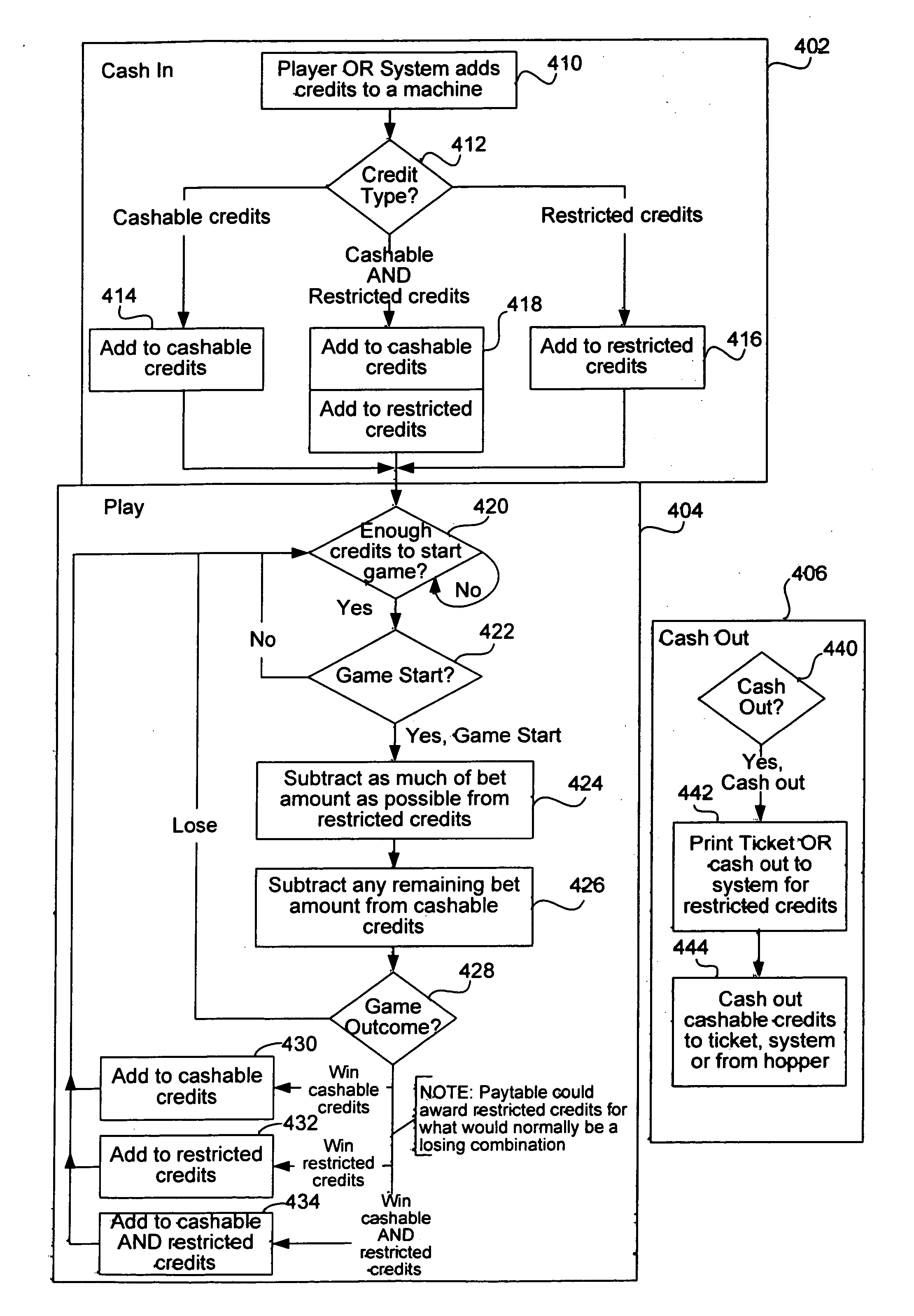

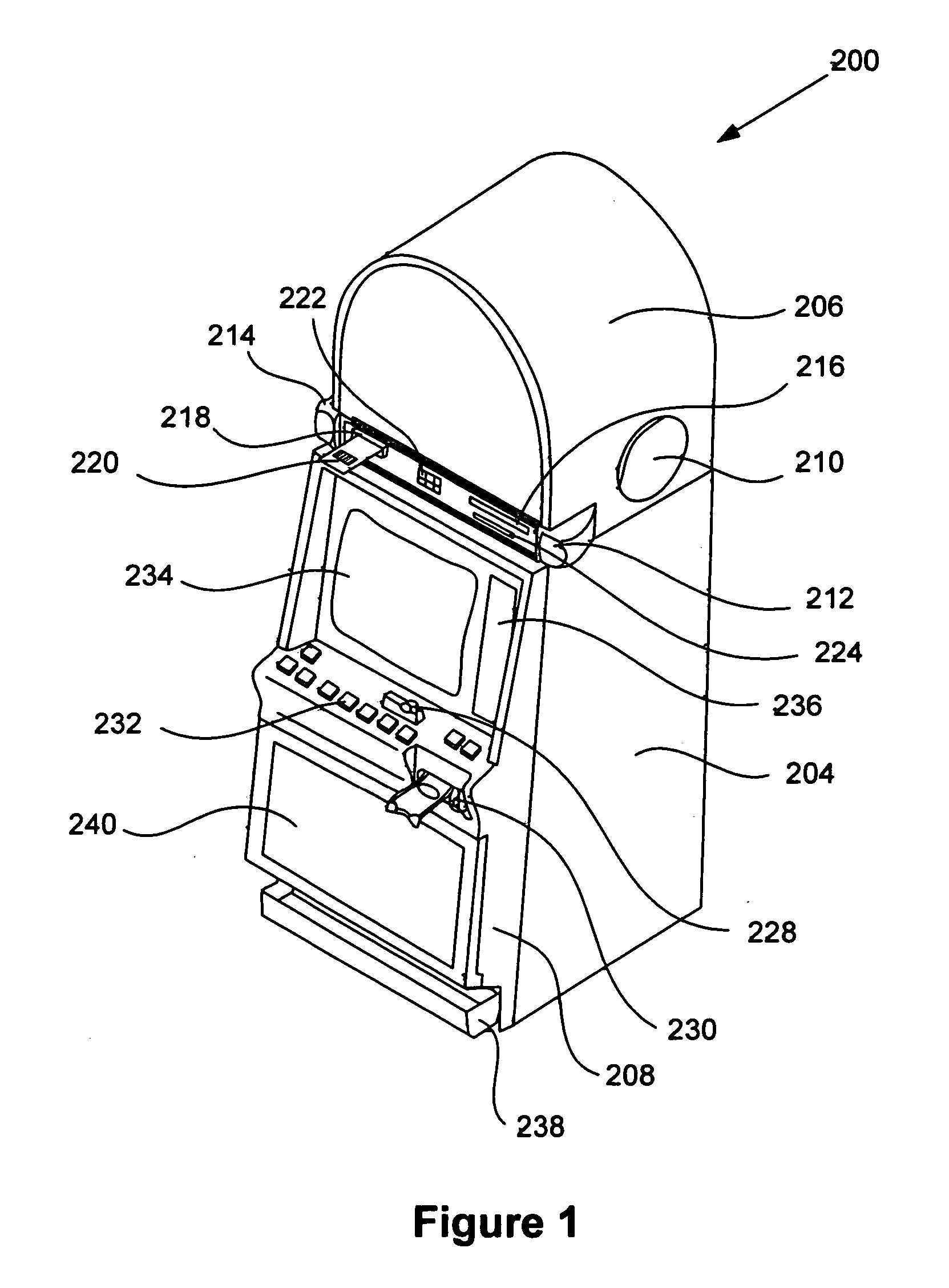

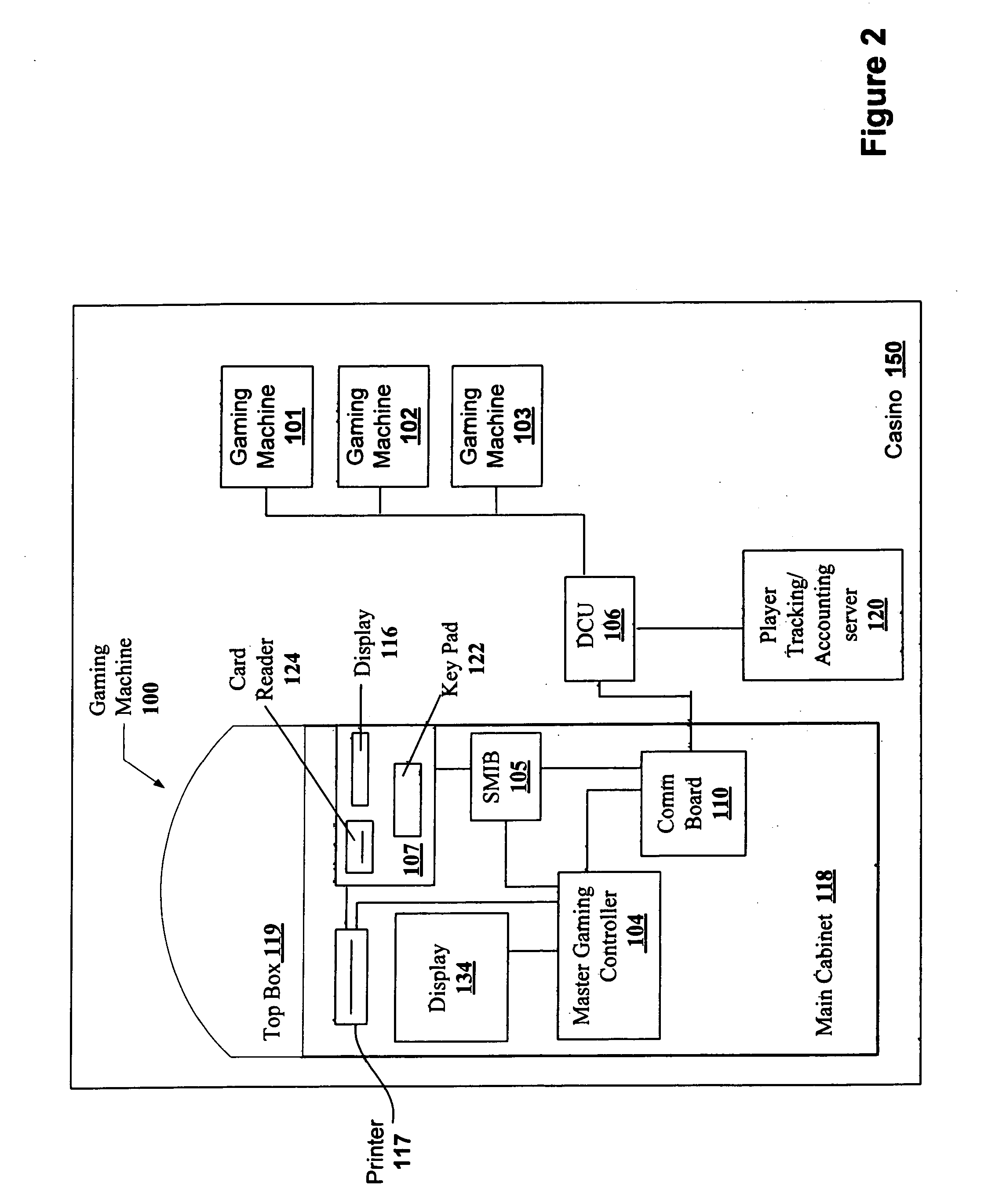

Wins of restricted credits in a gaming machine

InactiveUS7063617B2Without increasing financial liabilityEncouraging further playDiscounts/incentivesApparatus for meter-controlled dispensingOperating systemCredit limit

Disclosed is a gaming system and method designed or configured to provide wins of restricted credits. Restricted credits may be awarded according to the same or a different pay table than cashable credits on the same machine or at the same gaming property. Where separate pay tables are used for restricted and cashable credits, the invention may be implemented with a machine that accepts and pays only restricted credit according to a single, fixed internal payout schedule (“pay table”). Alternatively, the invention may be implemented with a machine that pays restricted credit according to one fixed internal pay table and cashable credit according to another fixed internal pay table. Or, a machine may pay restricted credit according to an external pay table provided by a host system to which the machine is connected.

Owner:IGT

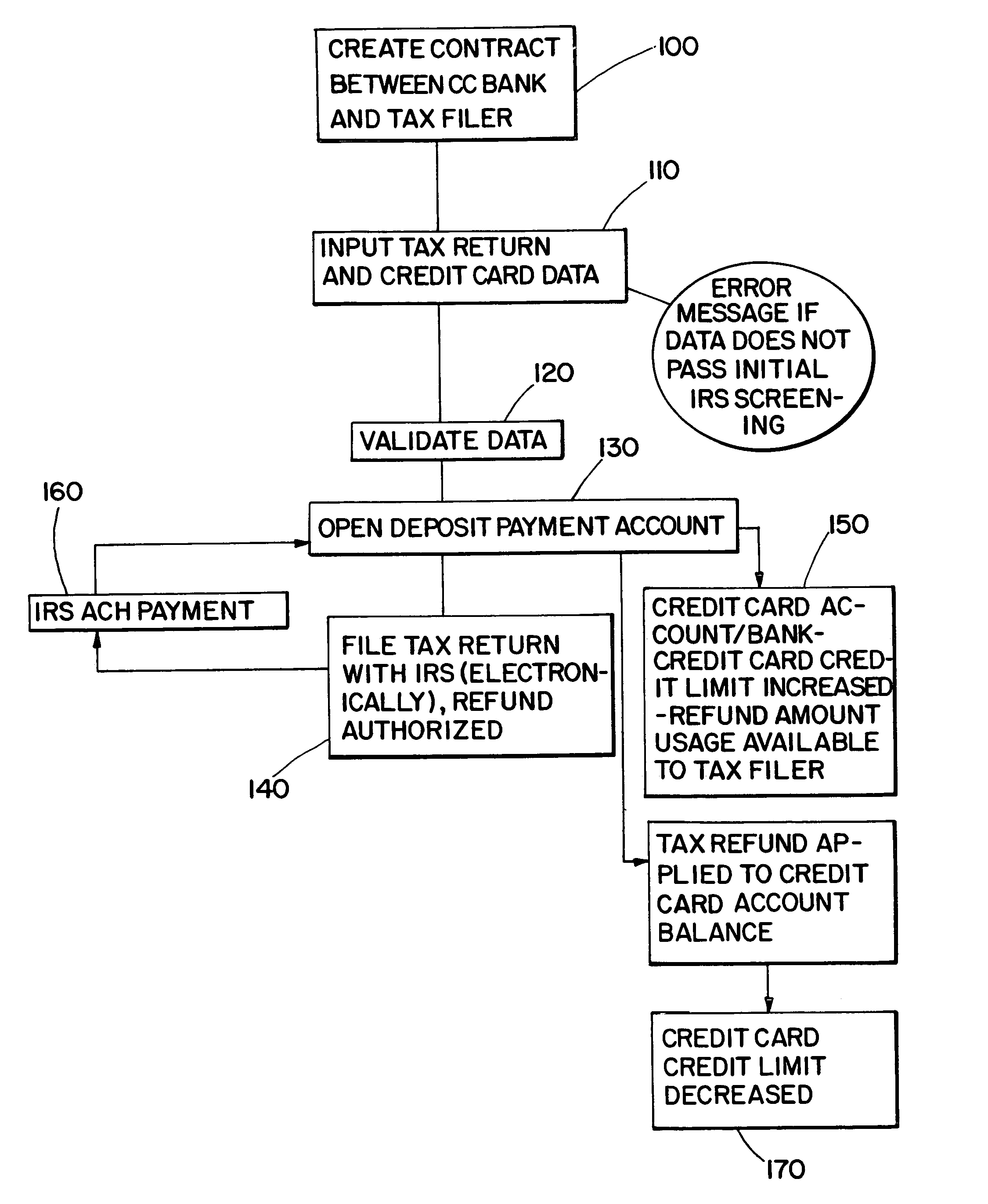

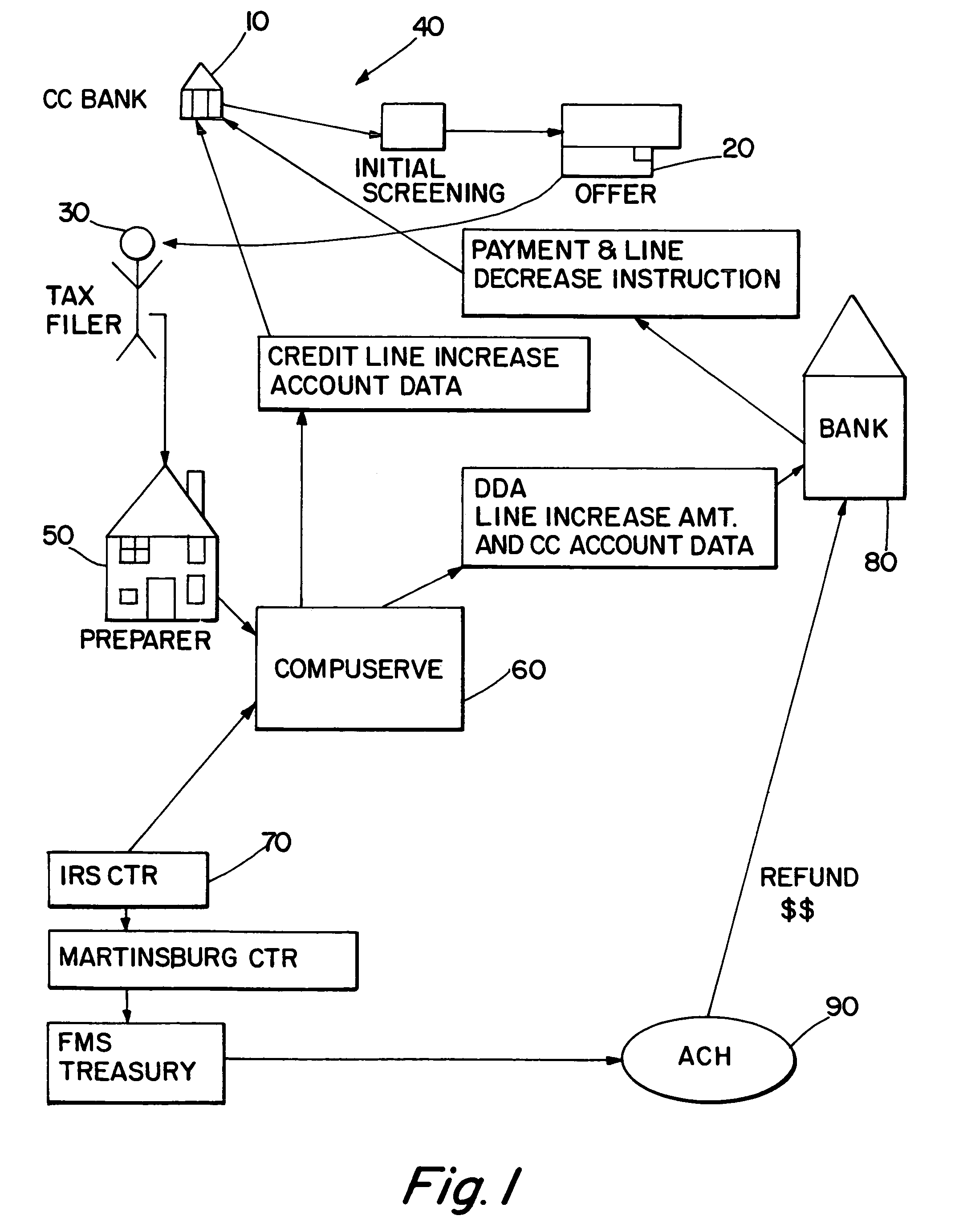

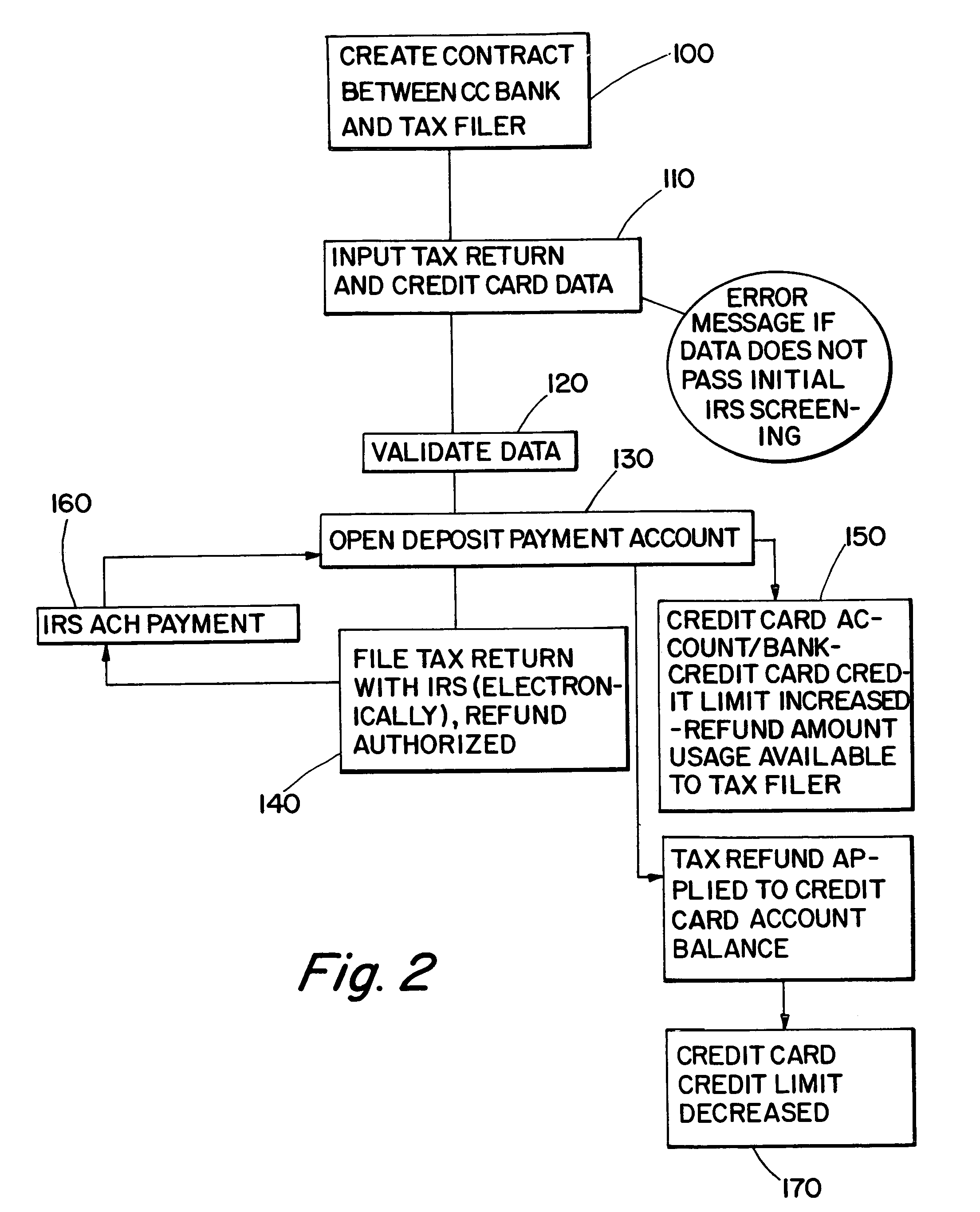

System providing funds to electronic tax filers prior to receipt of refund

Electronic data processing system which enables tax filers who electronically file tax returns to early use of their refund amount through an increased credit card credit limit with the tax payers credit card account.

Owner:BLOCK FINANCIAL

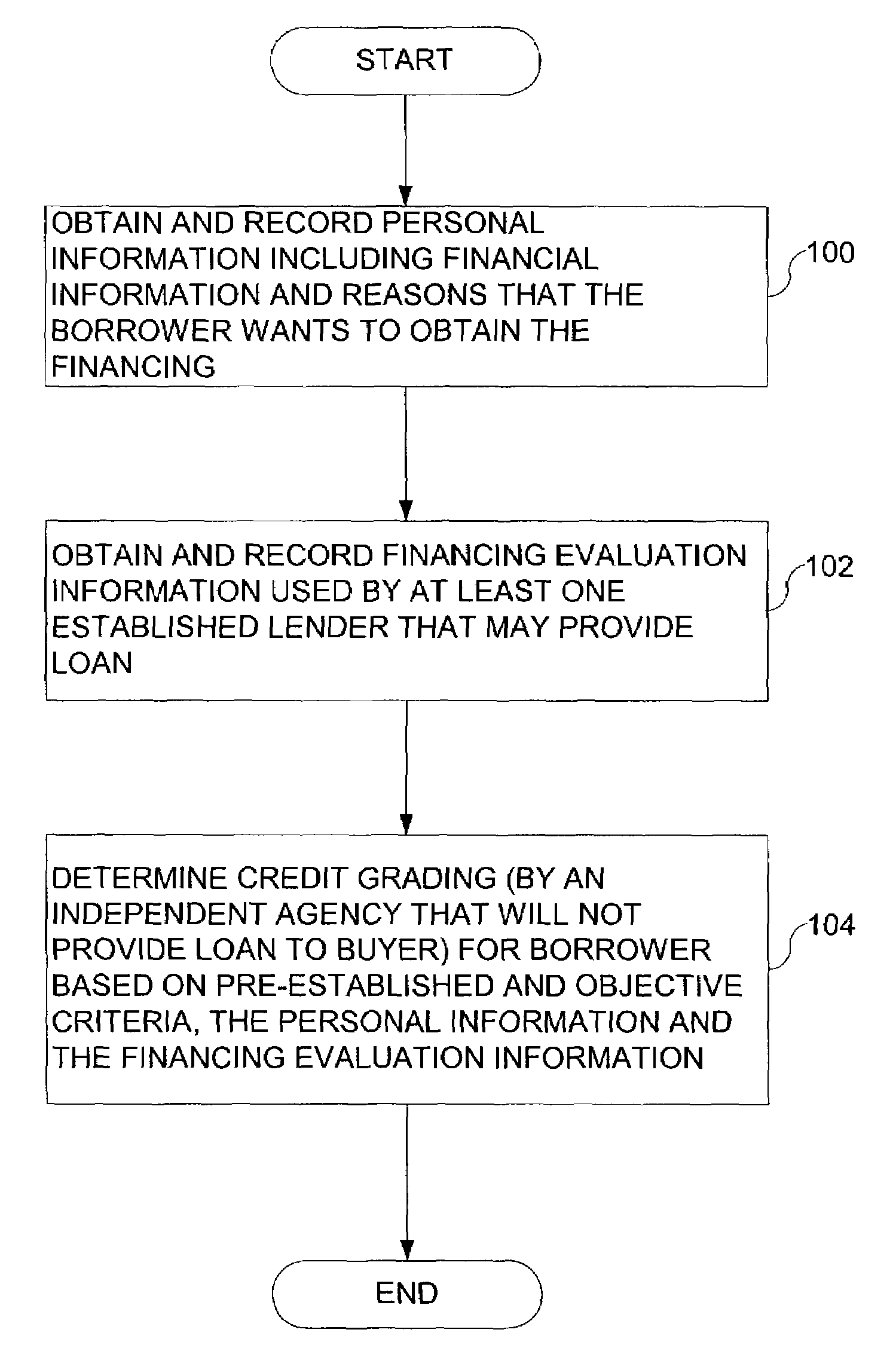

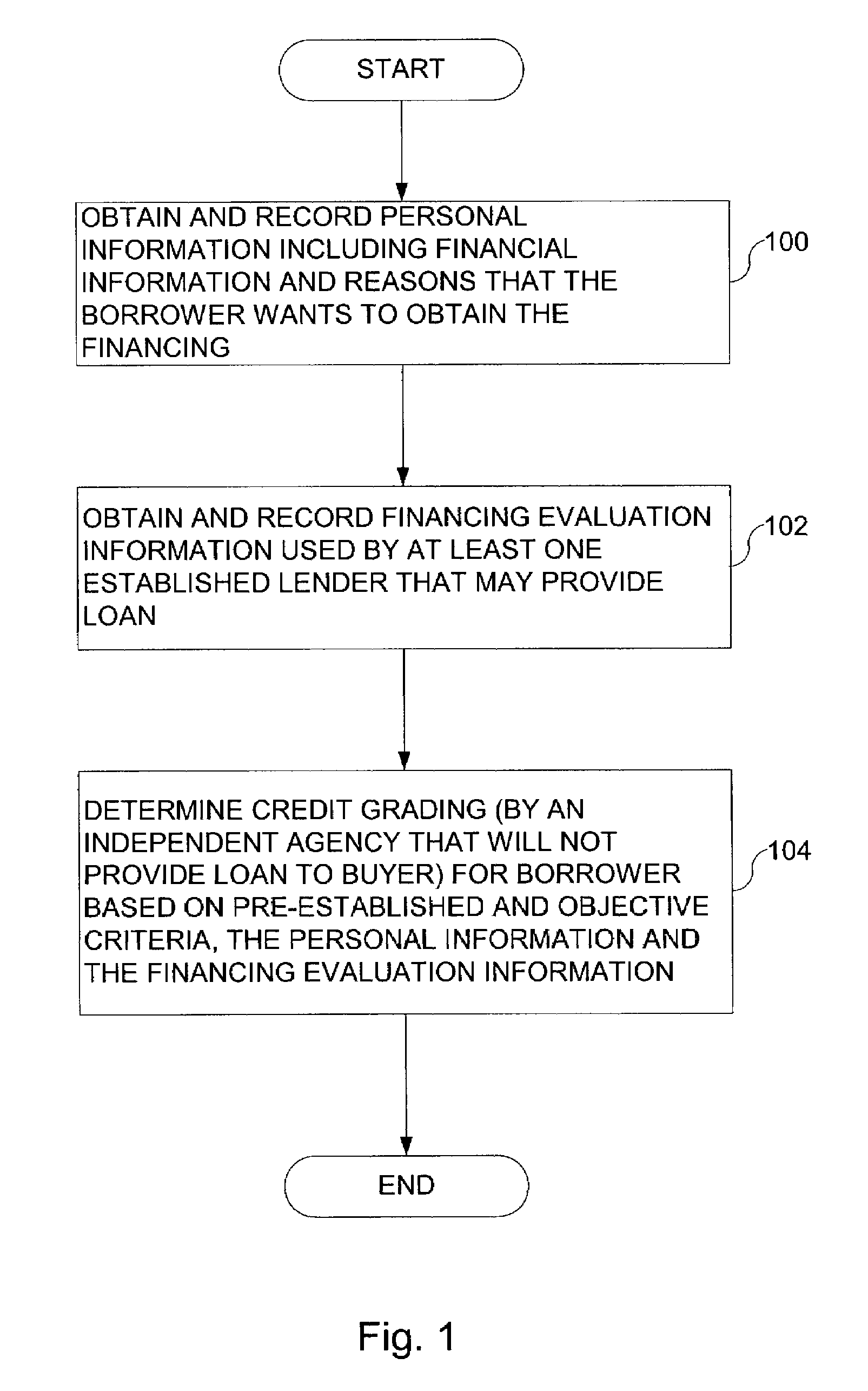

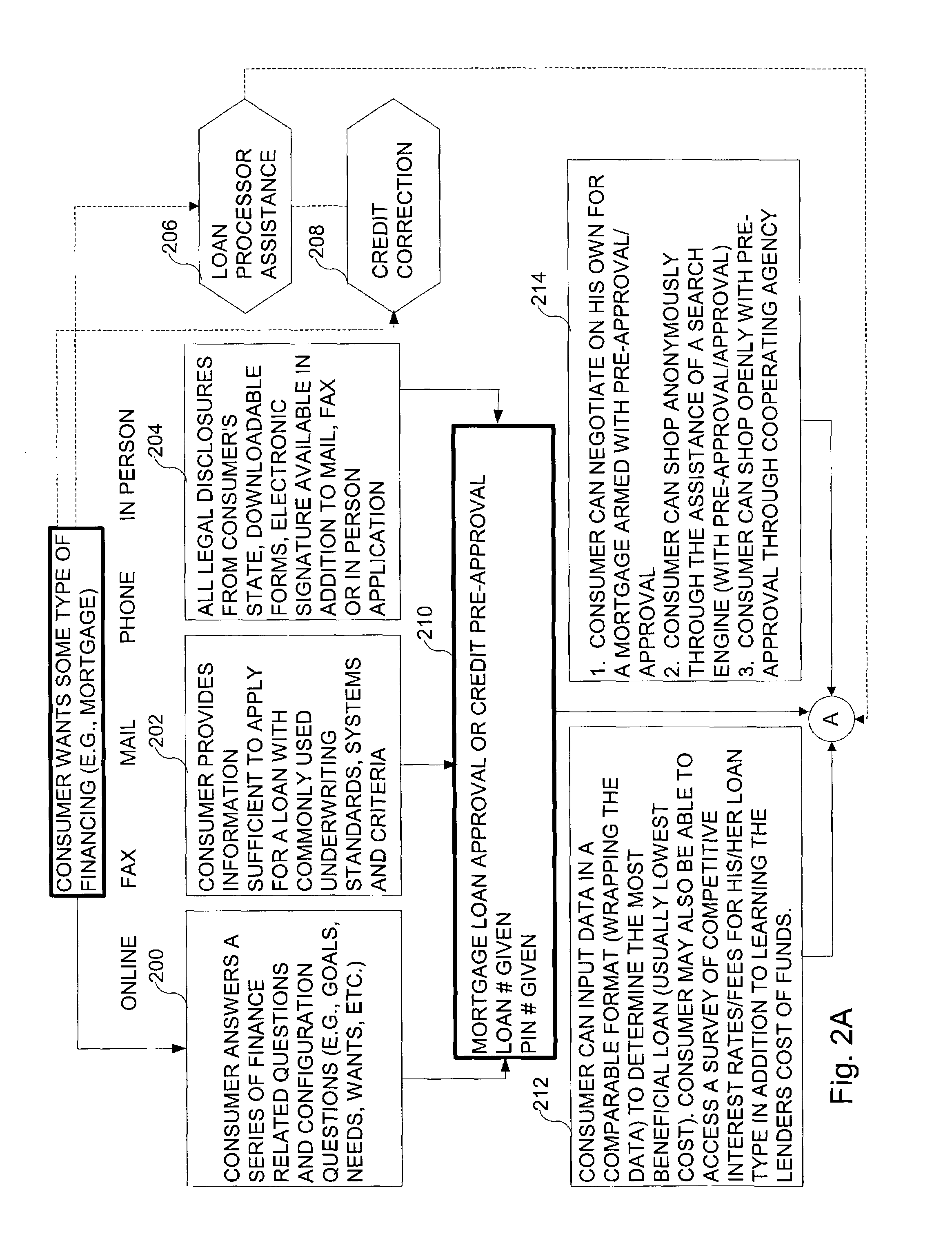

Credit/financing process

A method for a borrower to obtain and / or evaluate desired financial services is disclosed. Personal information from the borrower is obtained and recorded. The personal information includes reasons that the borrower wants to obtain the financing. Financing evaluation information based on pre-established and objective criteria used by at least one established financial institution that provides financing of the type sought by the borrower is obtained and recorded. A credit grading for the borrower is determined based on the personal information, and the financing evaluation information. The credit grading is determined by an independent entity that will not provide the financing to the borrower. The financing may be a loan, such as a mortgage loan or an auto loan or the financing may be the issuance of a credit card or a line of credit. The independent entity also compiles a comparison of closing costs associated with the financial transactions, and can optionally provide an estimate of those costs for one, and preferably for a variety of providers of the desired financing.

Owner:MORTGAGE GRADER

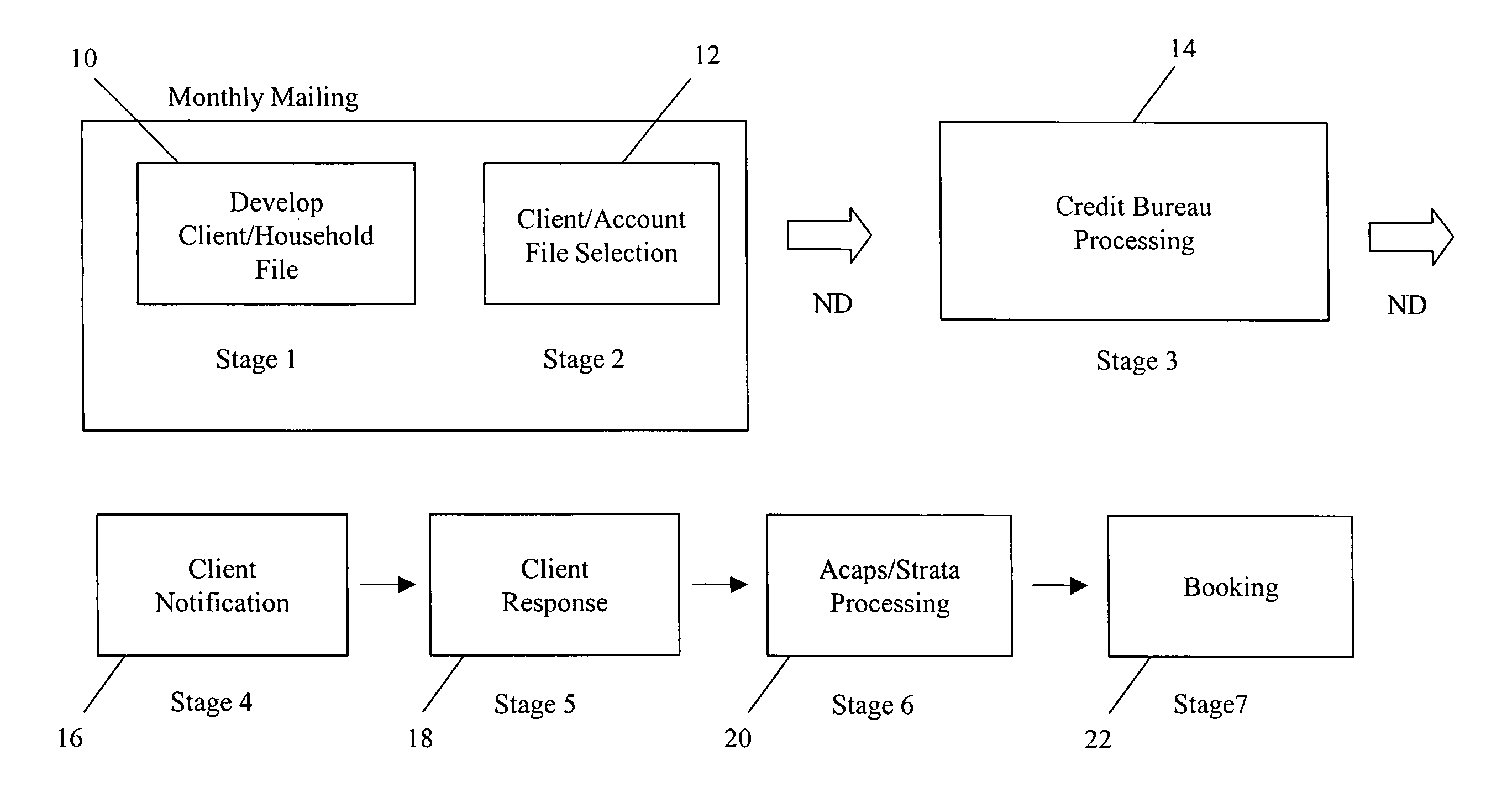

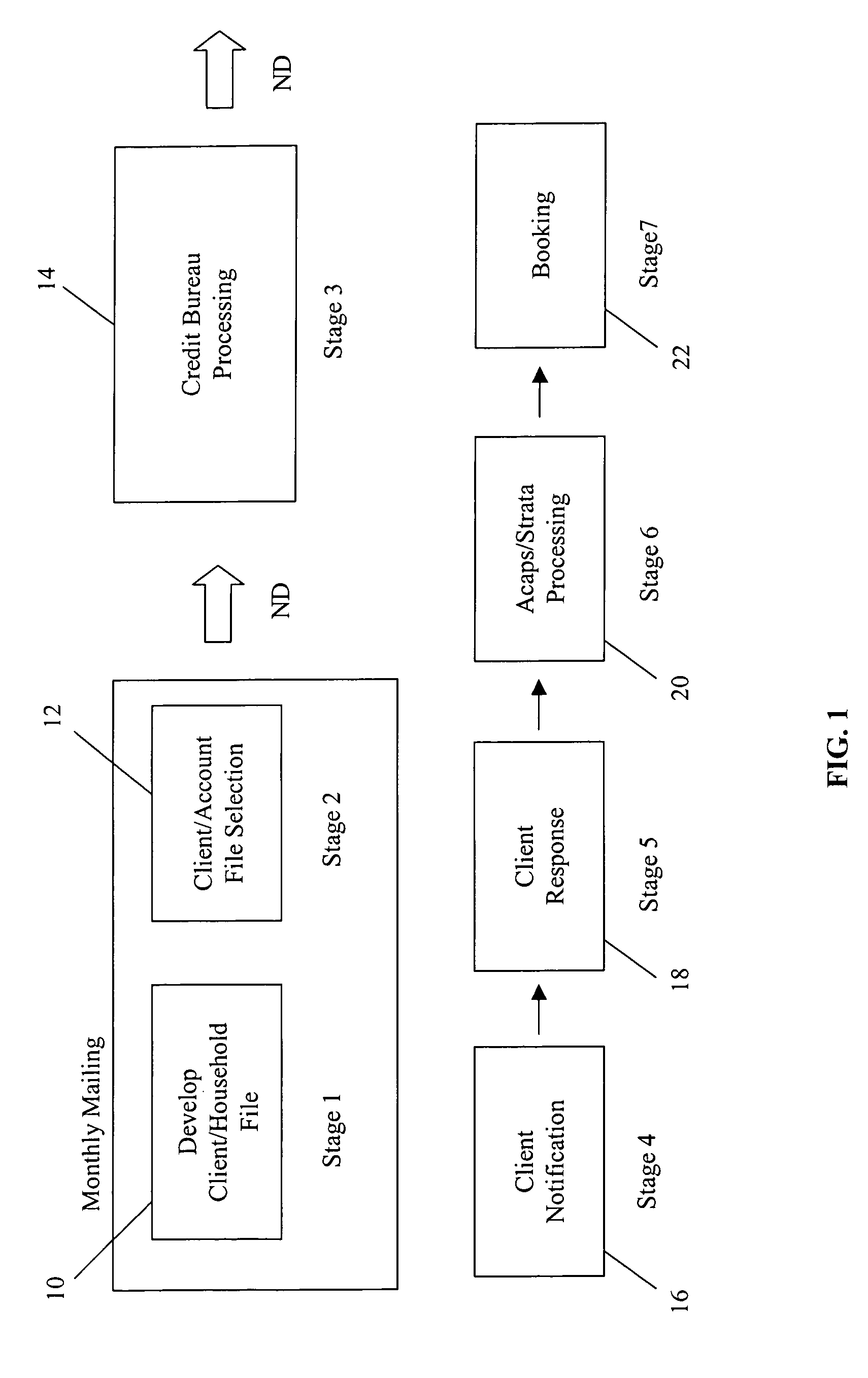

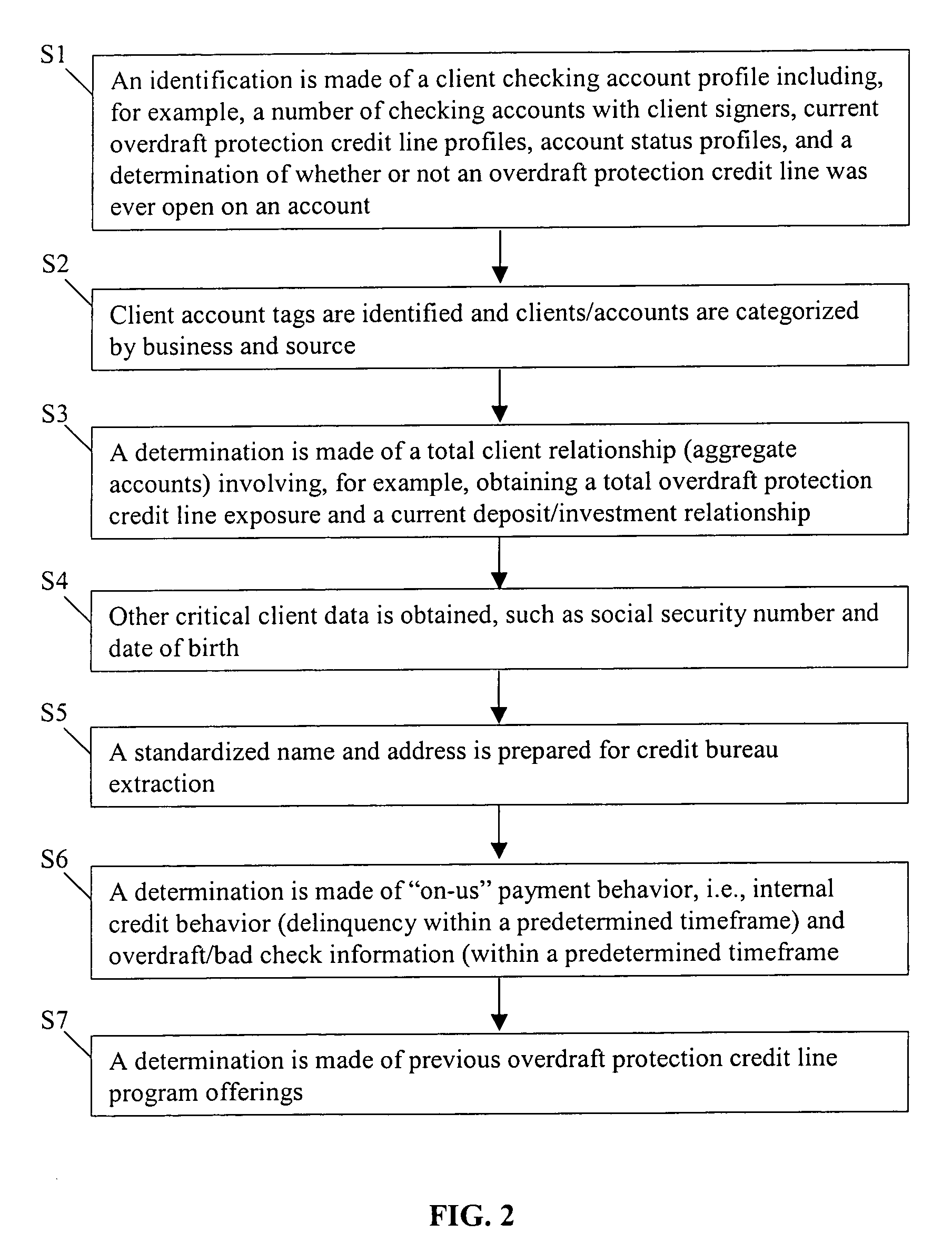

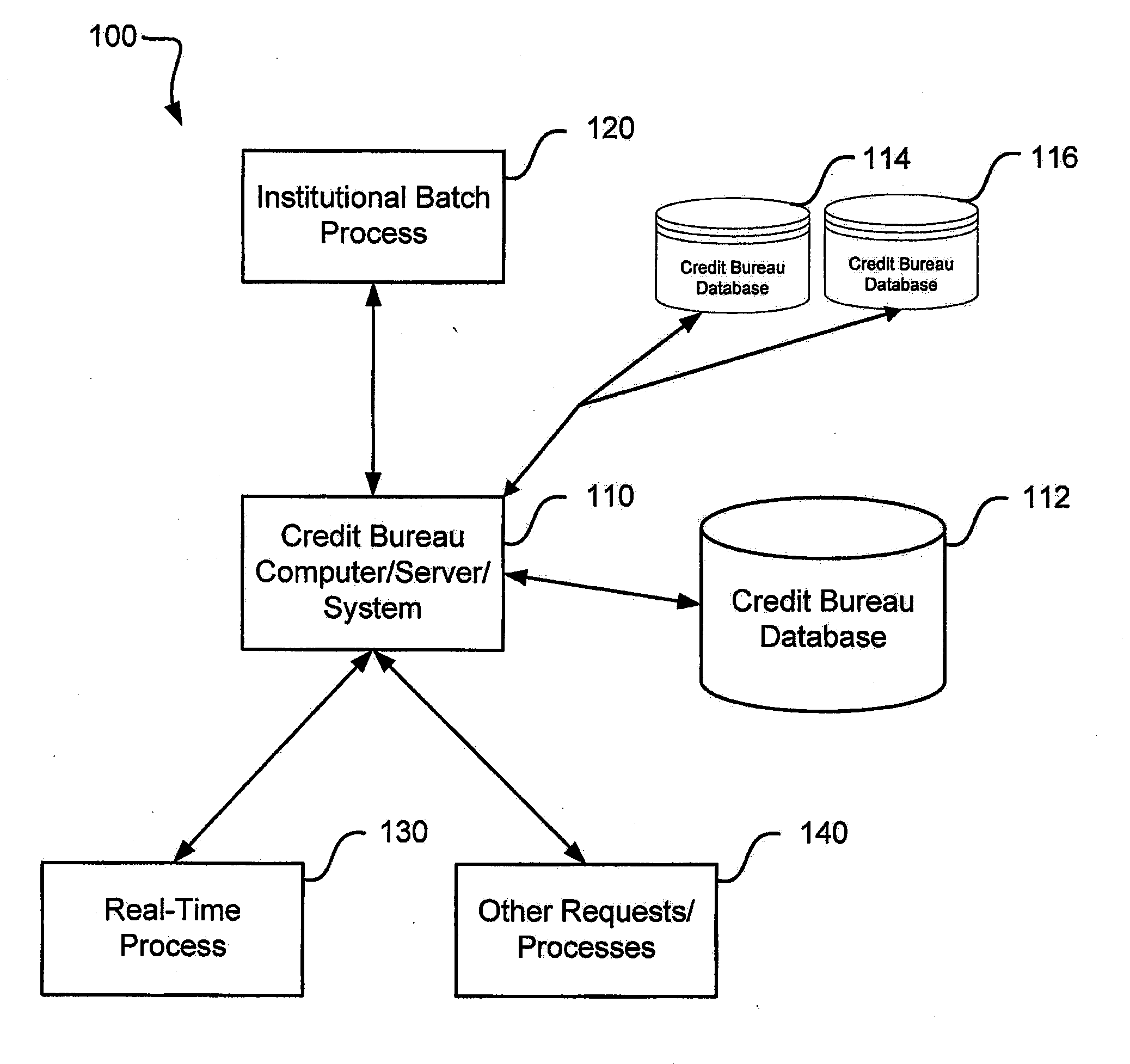

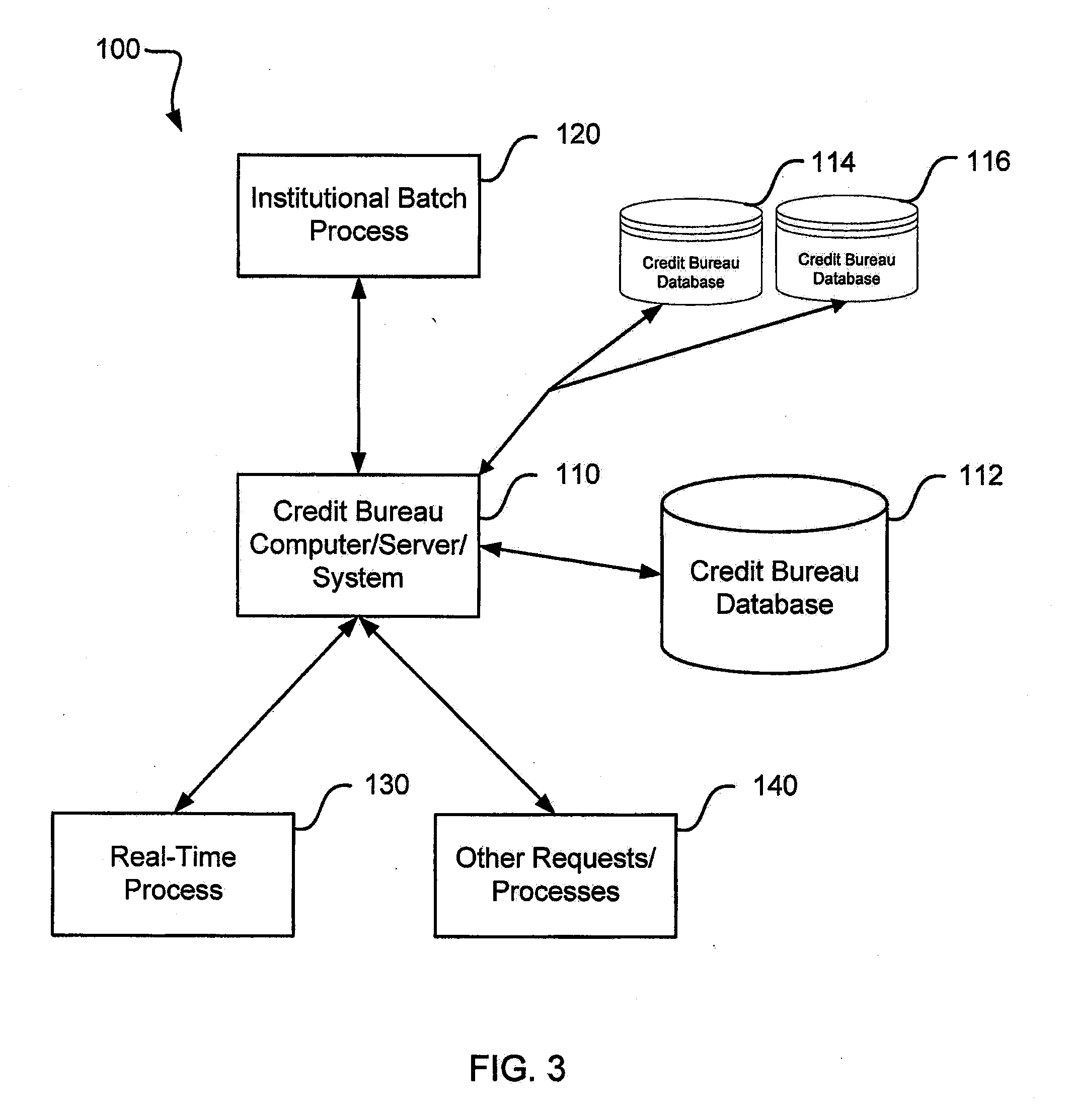

Systems and methods for offering credit line products

InactiveUS20060080251A1Improve experienceGenerate additional revenueFinancePayment architectureCredit limitDatabase

Computer implemented methods and systems for offering a credit line product to customers of a financial institution in which client household level files are created for financial institution customers, particular ones of which are then selected for a credit-line product offering based on client level and account level selection parameters, and the selected files are transferred electronically to a credit bureau. Thereafter, credit-screened account files corresponding to each of the selected client household level files with an appended credit score and credit line product terms are received from the credit bureau electronically by the financial institution for customer solicitations as determined by the credit bureau, and the customer solicitations are sent out by the financial institution.

Owner:CITIBANK

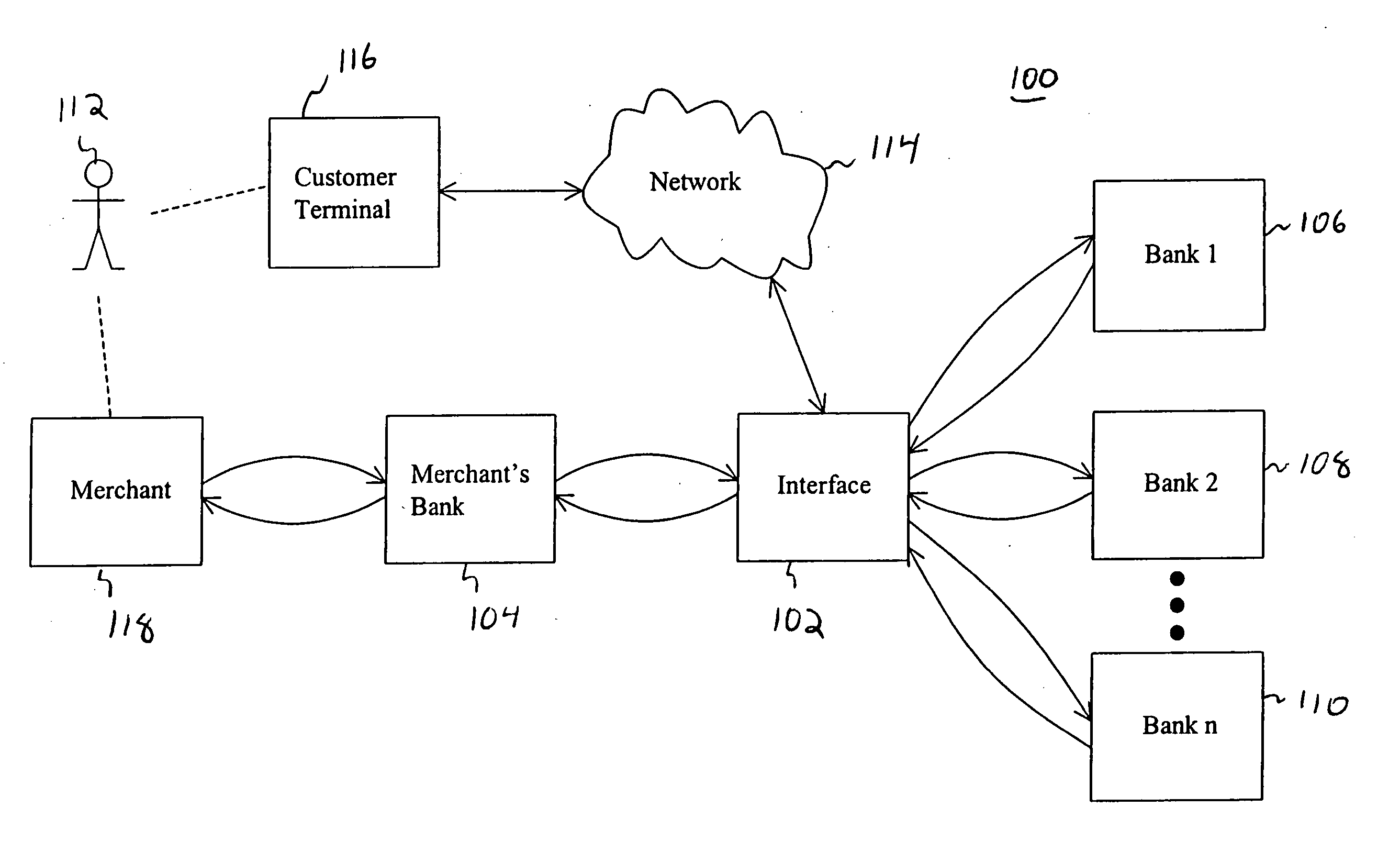

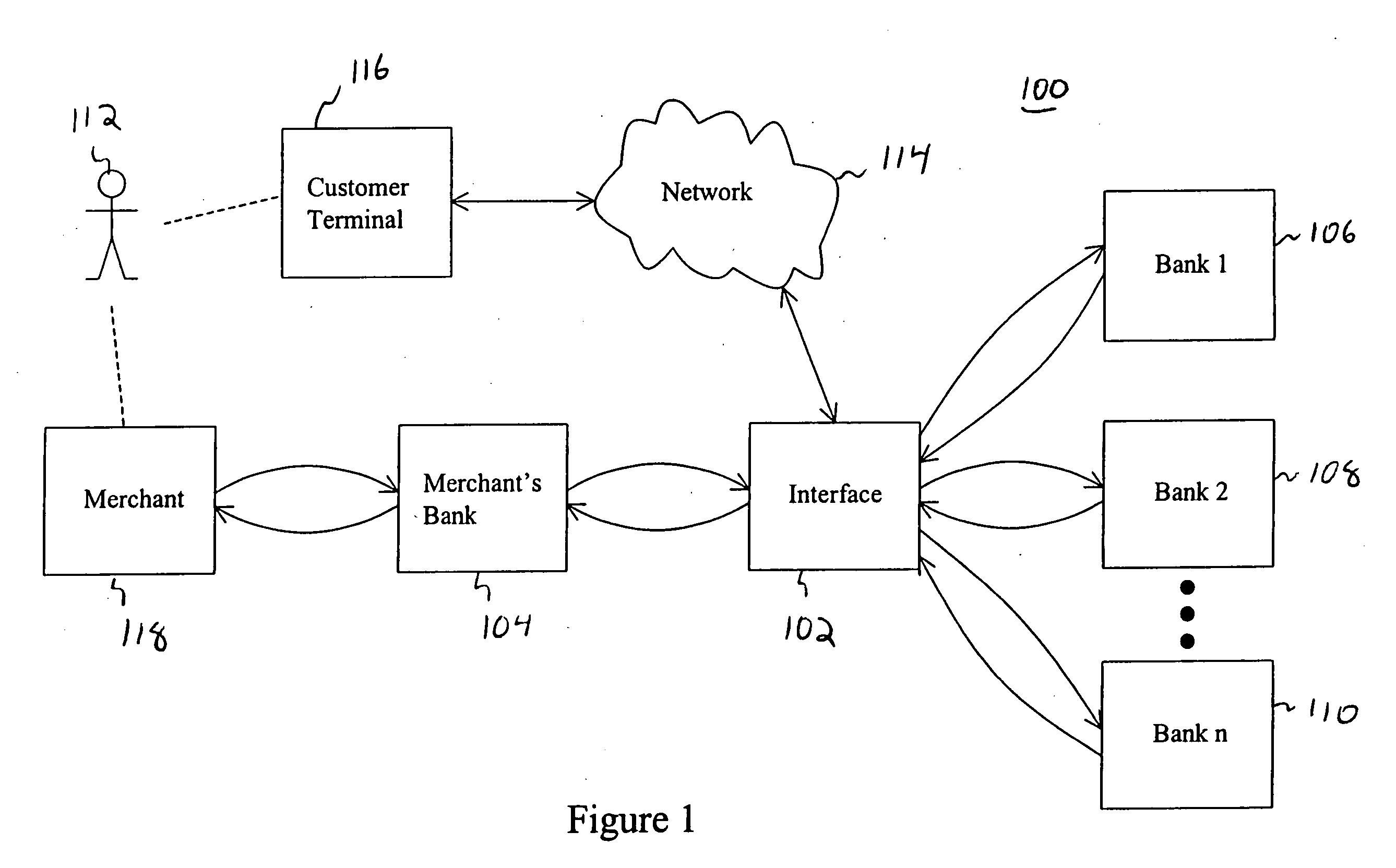

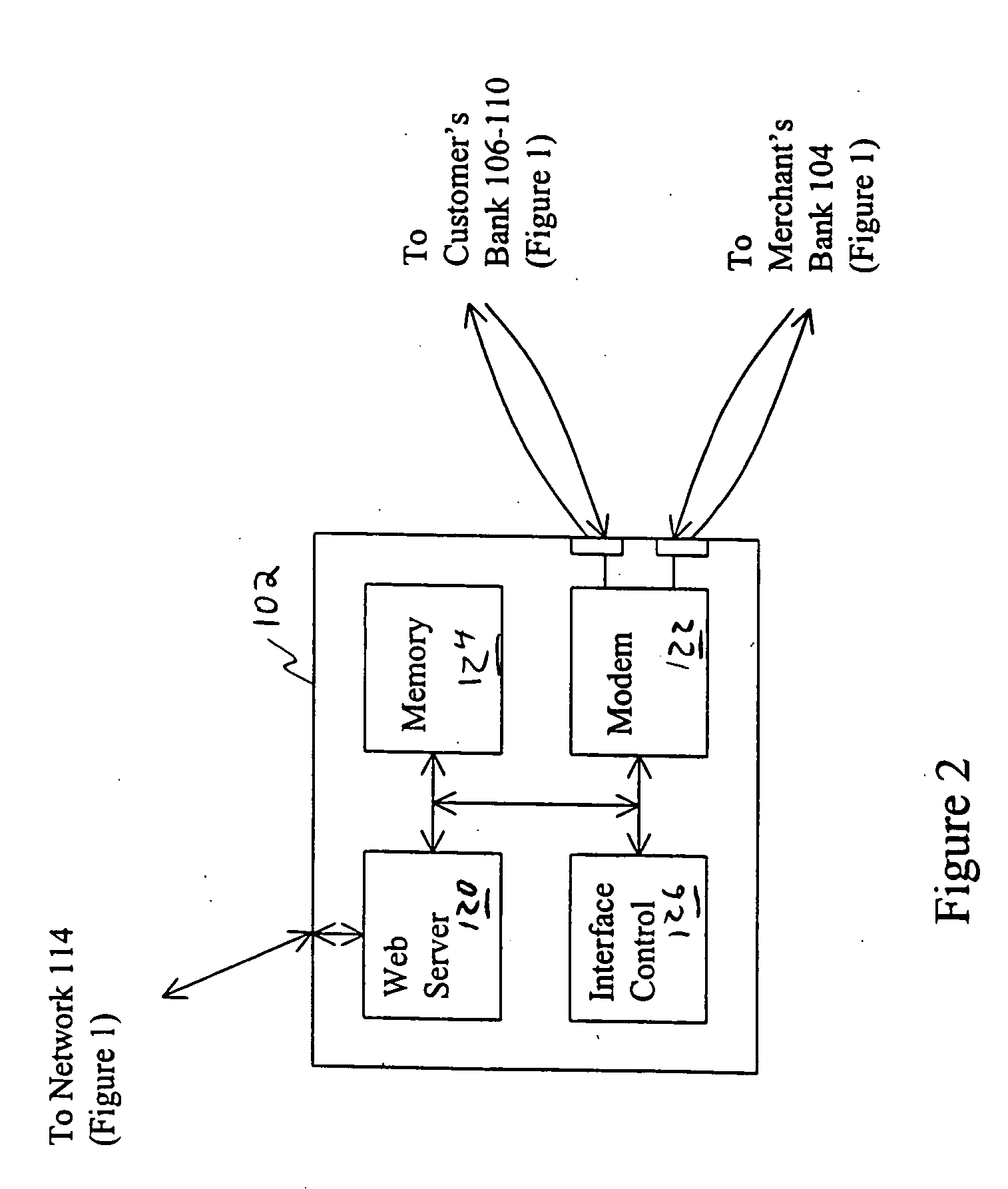

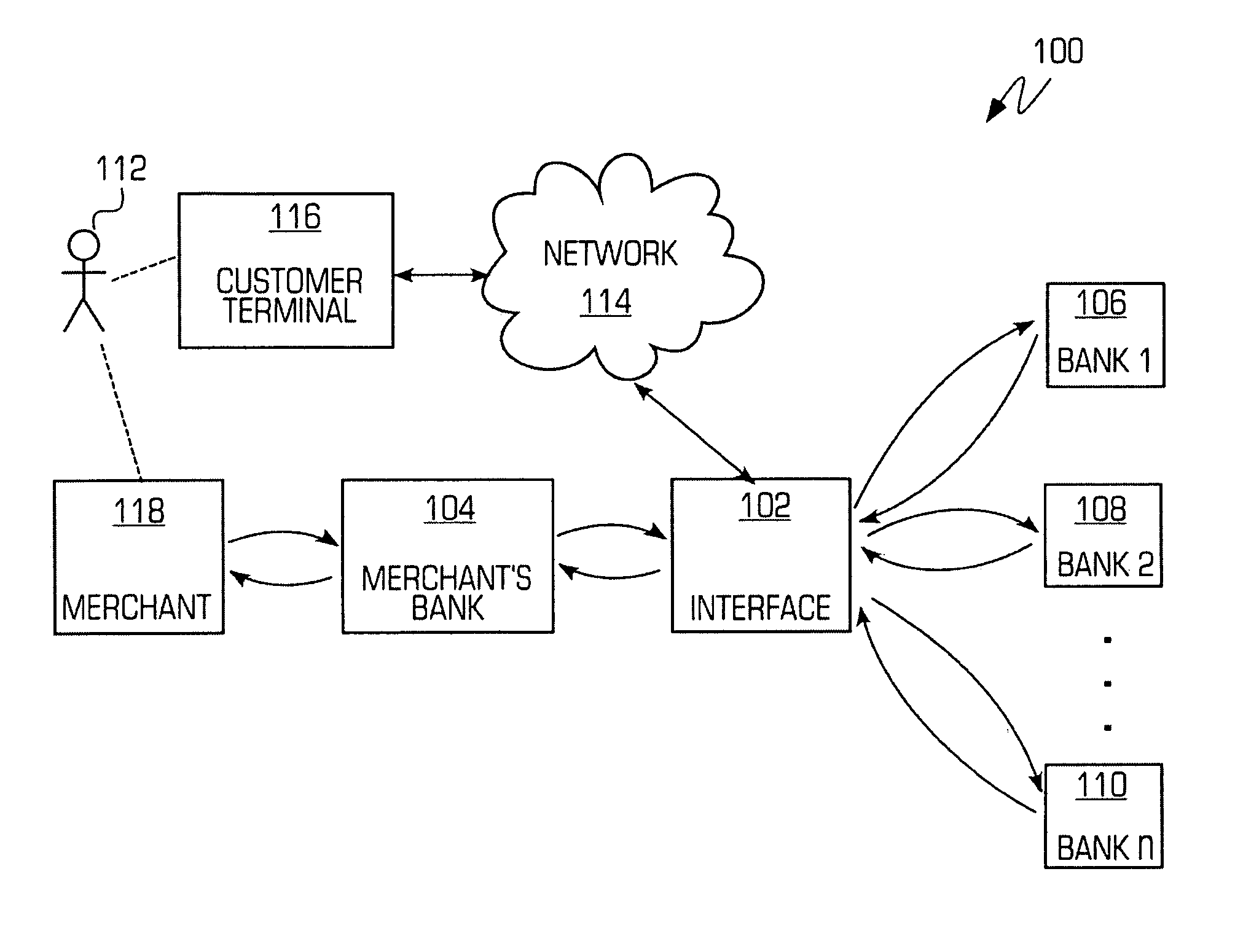

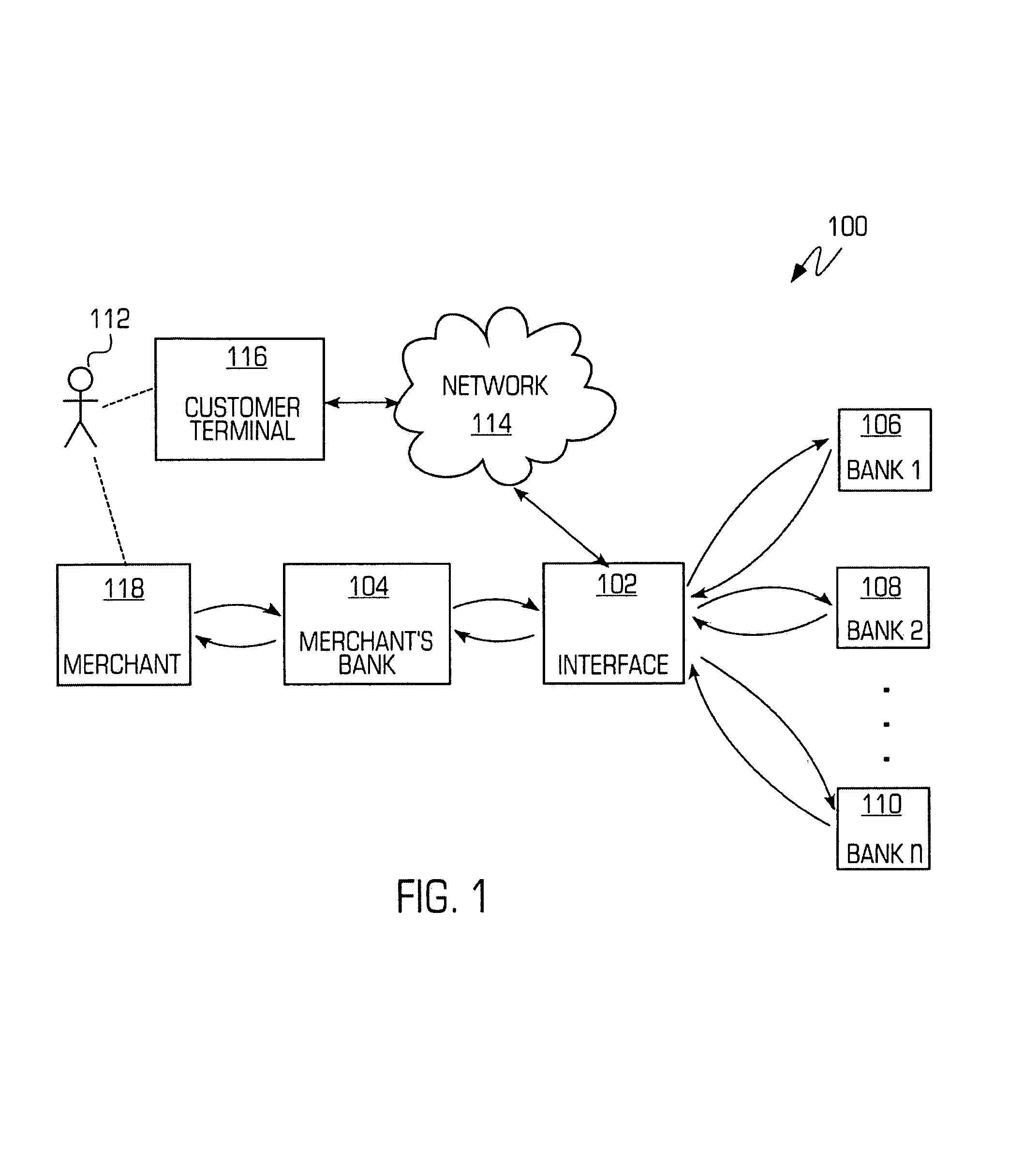

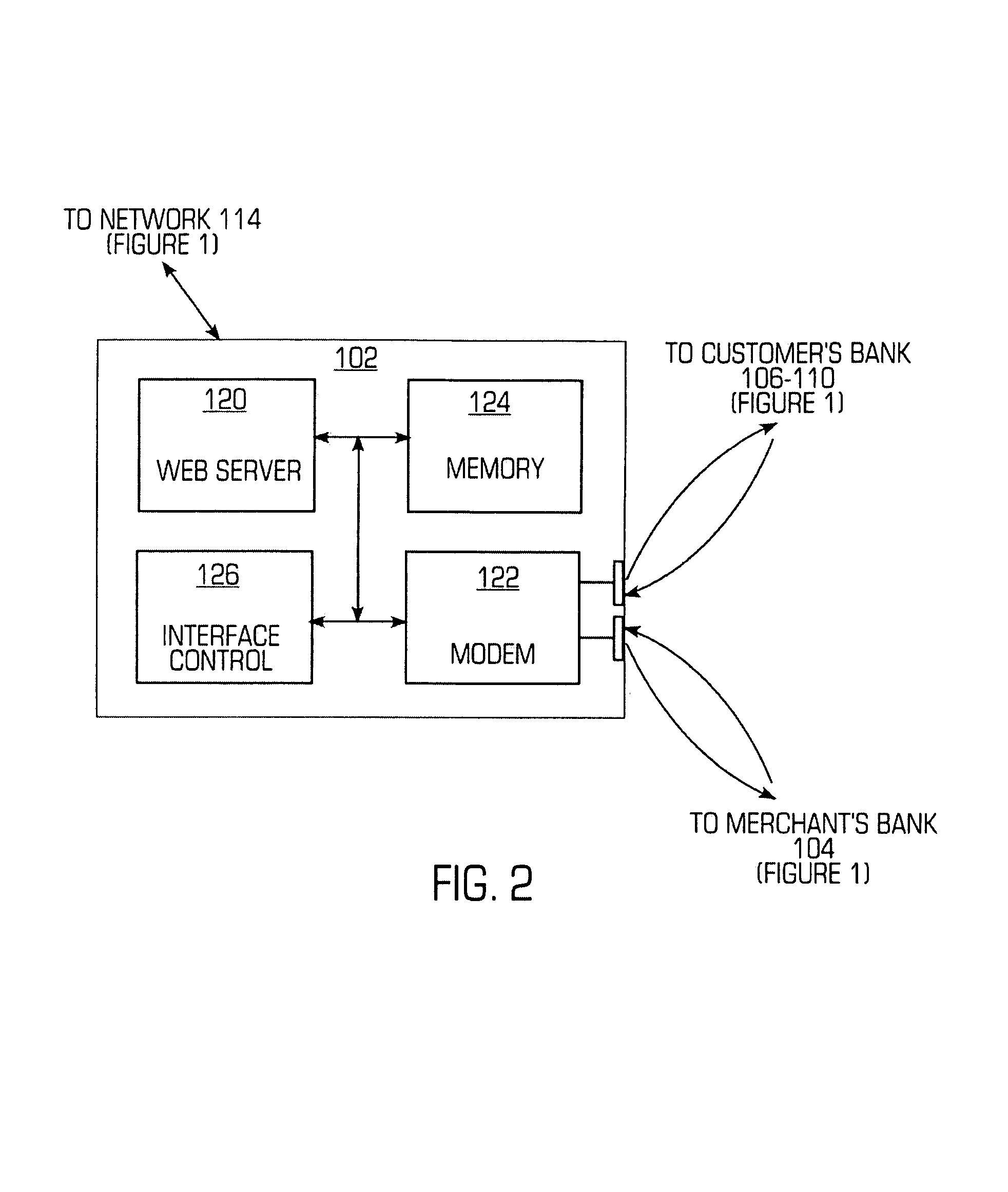

System and method for consumer control over card-based transactions

A system and method for consumer control over card-based transactions and associated accounts. An interface is provided between a merchant or the merchant's bank and the bank or banks at which the consumer has accounts for card-based transactions. The interface acts as an intermediary which is accessible to the consumer so that the consumer may place a variety of controls on card-based transactions. For example, multiple transaction cards may be linked to a single credit account with each card having a different credit limit. As another example, each transaction card may be restricted to a particular merchant. As yet another example, a consumer may link several credit and / or debit accounts to a single transaction card; the consumer may pre-select criteria to be utilized for directing charges for a particular transaction to be applied the different accounts. The consumer may access the interface via a web site or a telephone for making changes and receiving account information. Flexibility and control over the use of transaction cards is, therefore, provided for card-based transactions and for debit and credit accounts used in connection with such card-based transactions.

Owner:MASTERCARD INT INC

System and method for consumer control over card-based transactions

A system and method for consumer control over card-based transactions and associated accounts. An interface is provided between a merchant or the merchant's bank and the bank or banks at which the consumer has accounts for card-based transactions. The interface acts as an intermediary which is accessible to the consumer so that the consumer may place a variety of controls on card-based transactions. For example, multiple transaction cards may be linked to a single credit account with each card having a different credit limit. As another example, each transaction card may be restricted to a particular merchant. As yet another example, a consumer may link several credit and / or debit accounts to a single transaction card; the consumer may pre-select criteria to be utilized for directing charges for a particular transaction to be applied the different accounts. The consumer may access the interface via a web site or a telephone for making changes and receiving account information. Flexibility and control over the use of transaction cards is, therefore, provided for card-based transactions and for debit and credit accounts used in connection with such card-based transactions.

Owner:MASTERCARD INT INC

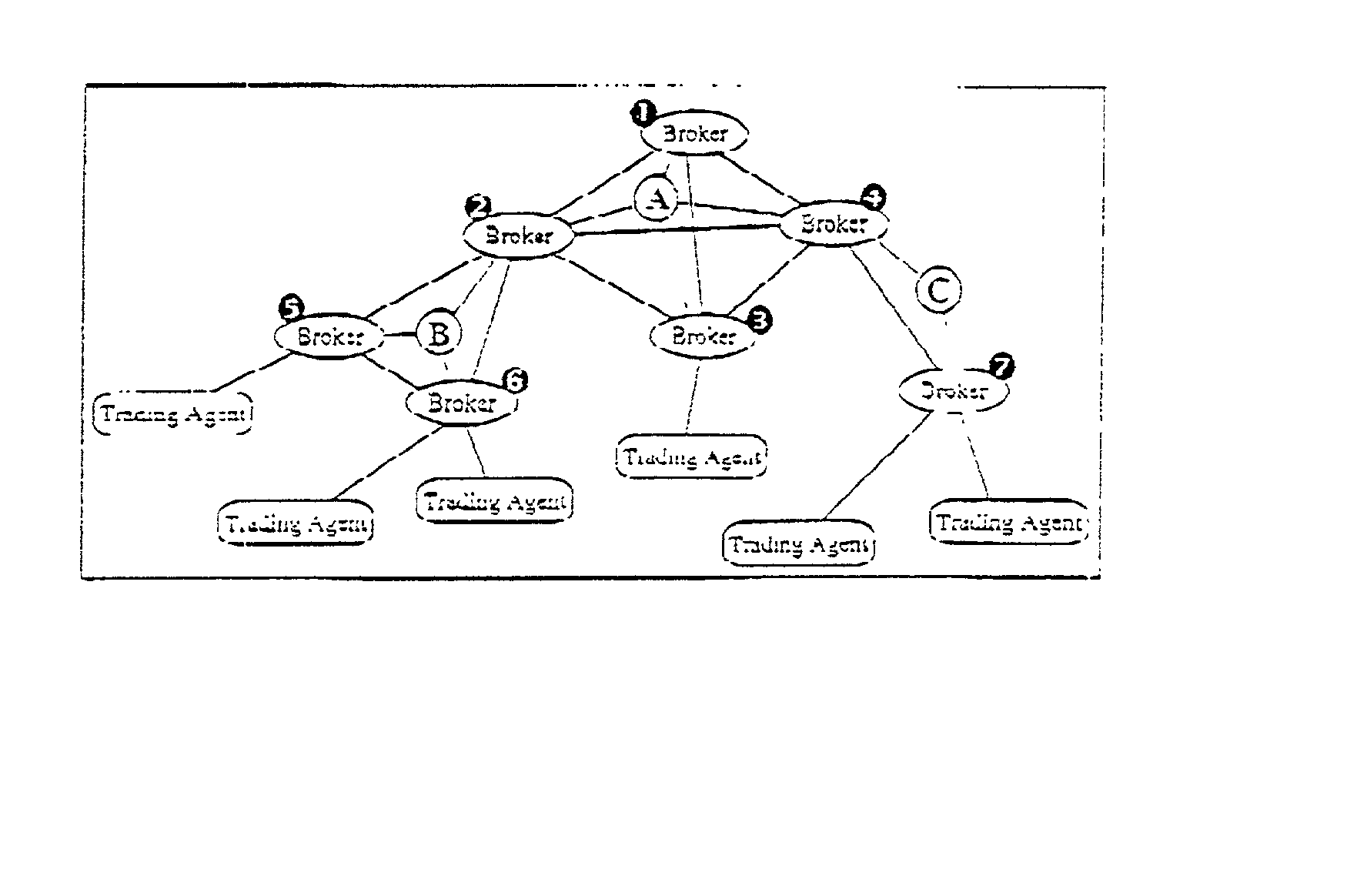

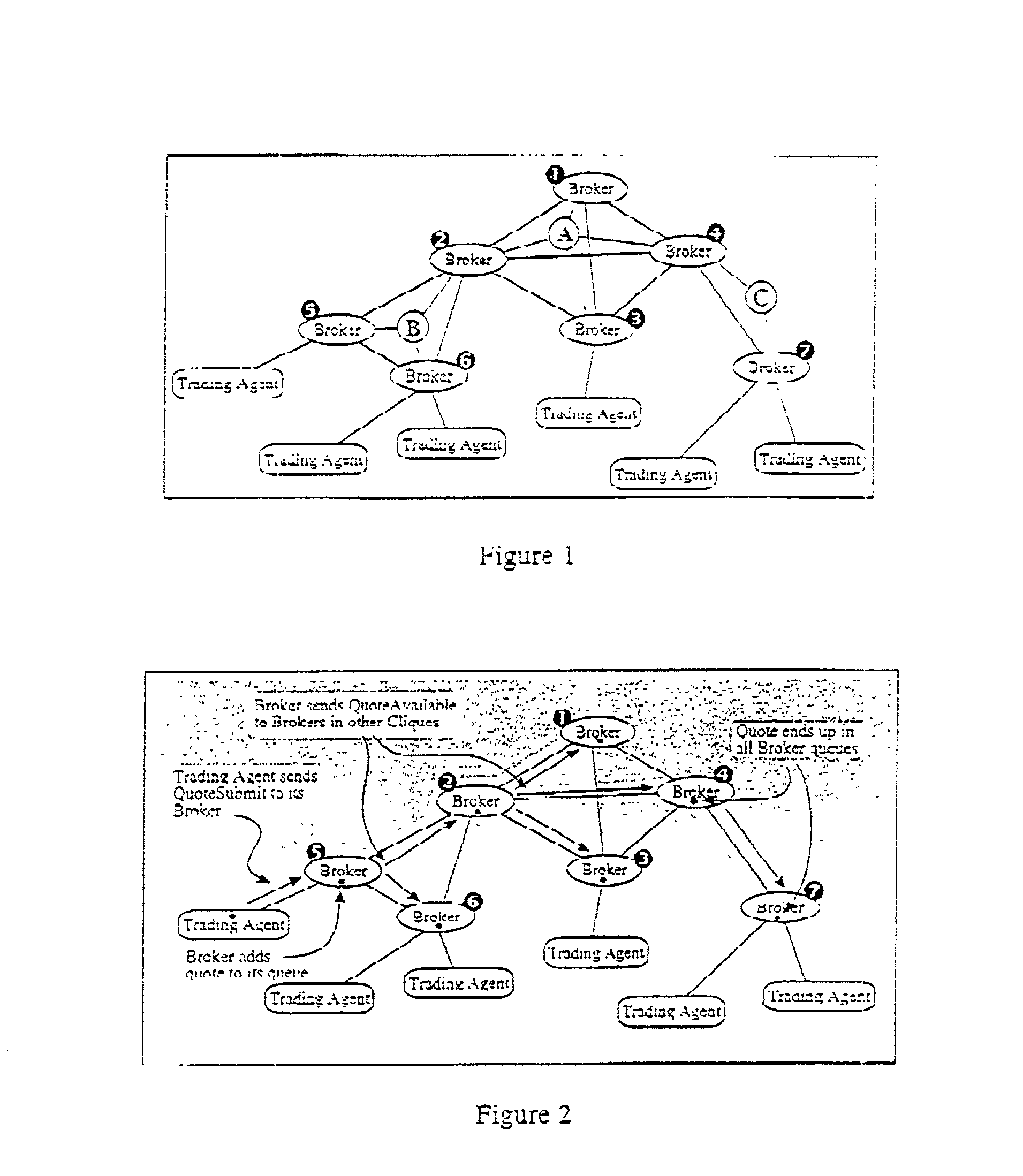

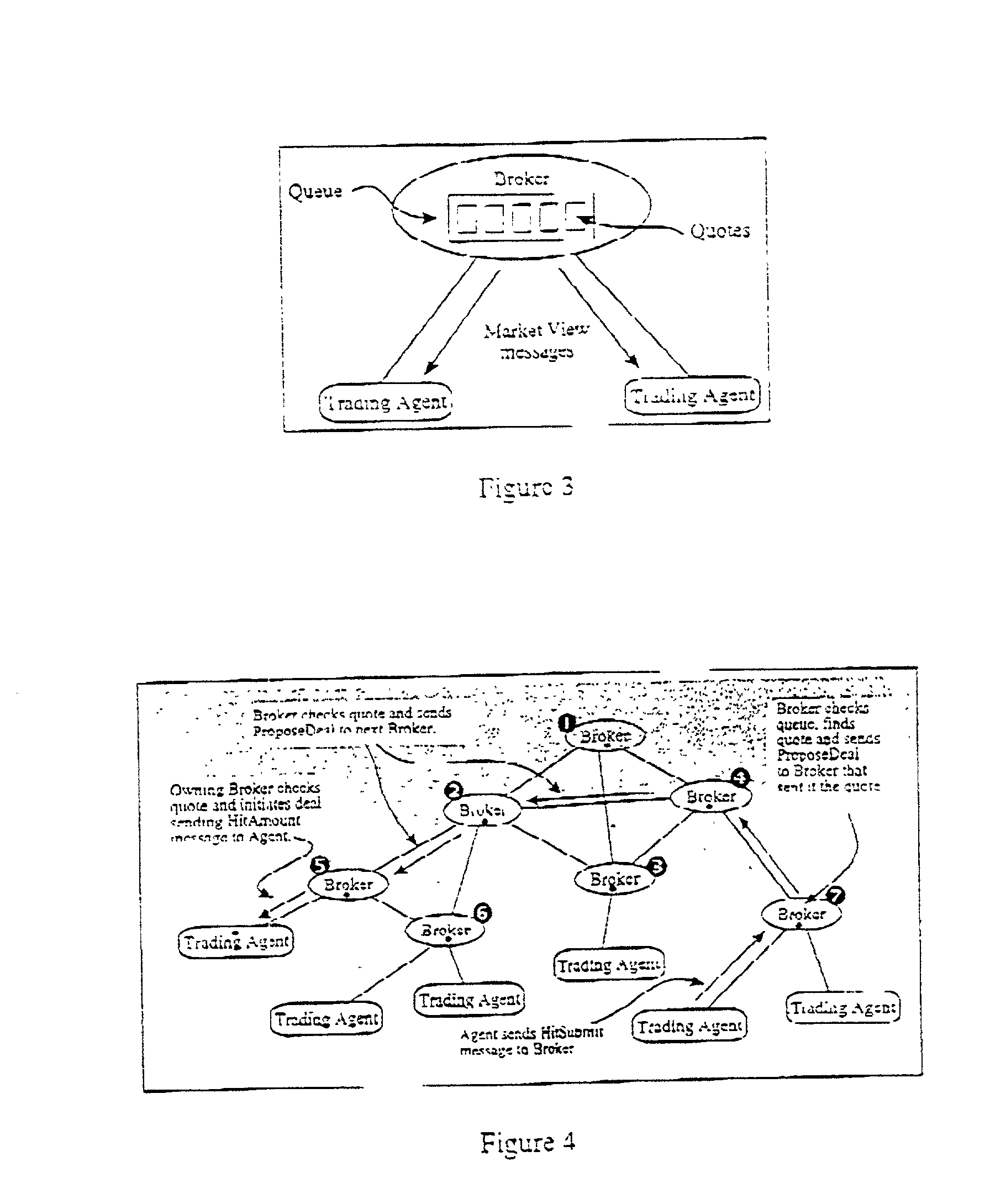

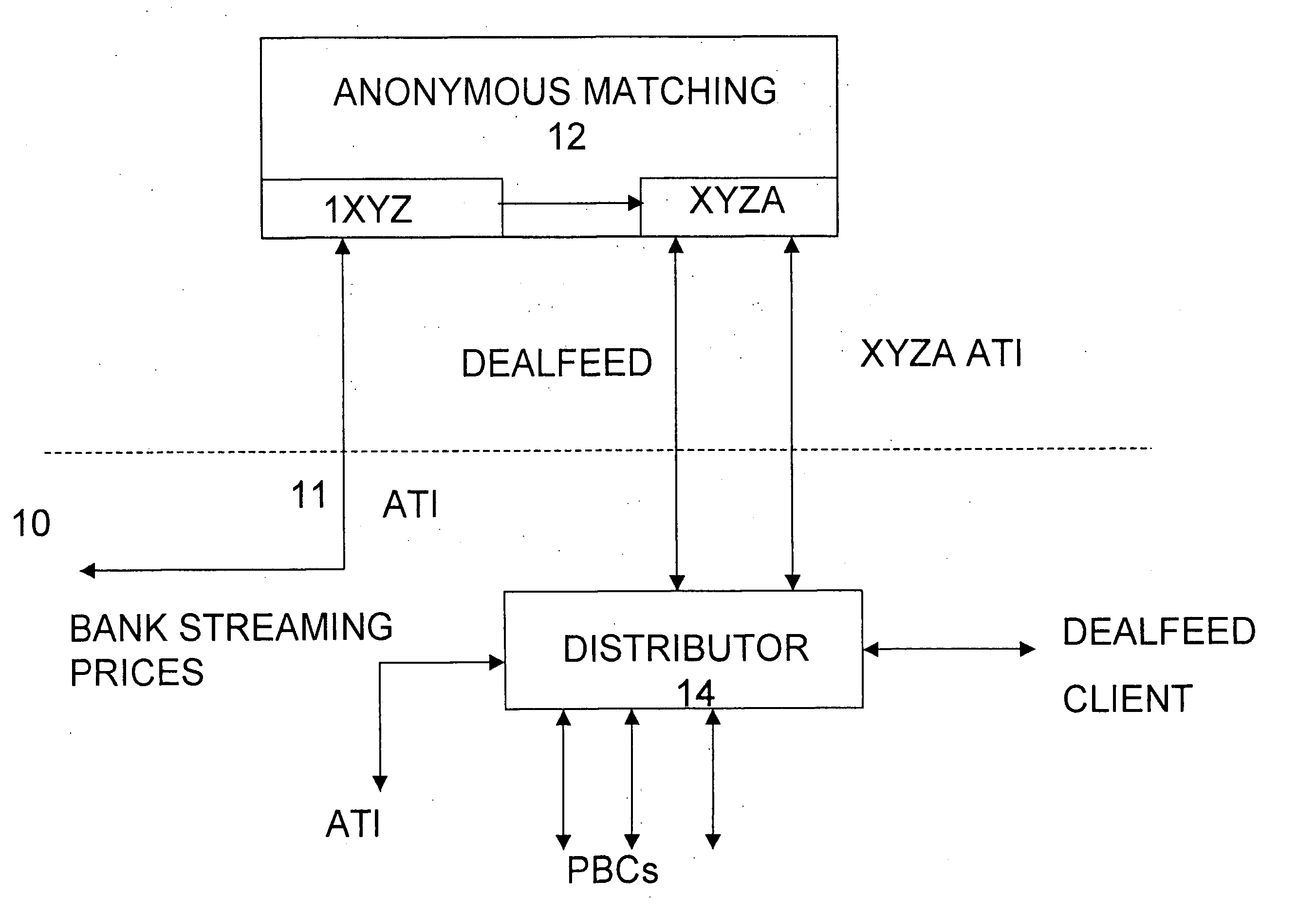

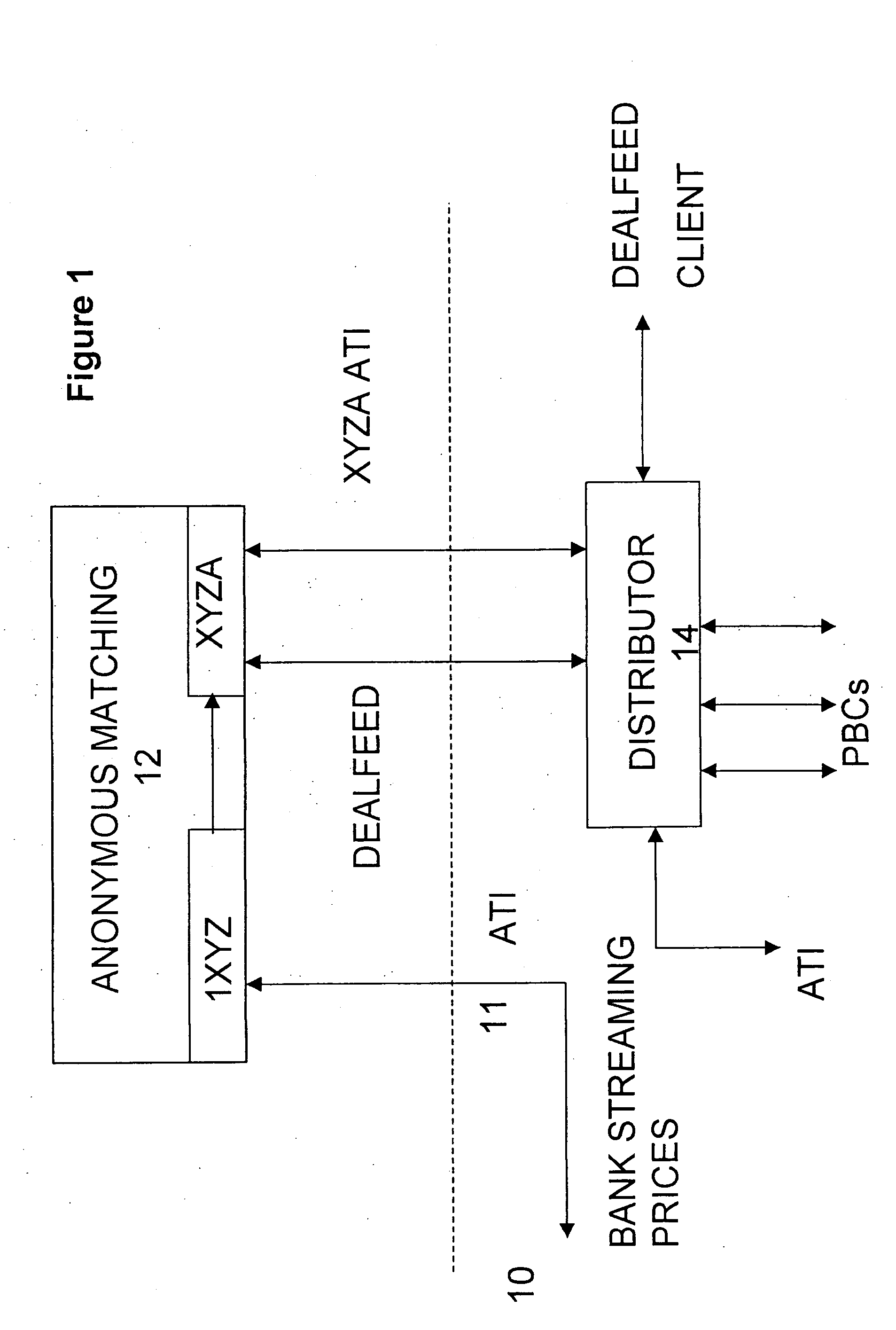

Credit handling in an anonymous trading system

InactiveUS20020099641A1Amount of creditReduce capacityFinancePayment architectureEngineeringCredit limit

In an anonymous trading system, credit between counterparties is effectively increased by netting buy and sell trades to reflect the true risk to which each party is exposed. Credit limits are adjusted by calculating the exposure in each currency at the relevant time and then converted into the credit limit currency equivalent. The credit limits are adjusted accordingly. The resulting credit limits may be different for bids and offers by or from a given counterparty.

Owner:NEX SERVICES NORTH AMERICA +2

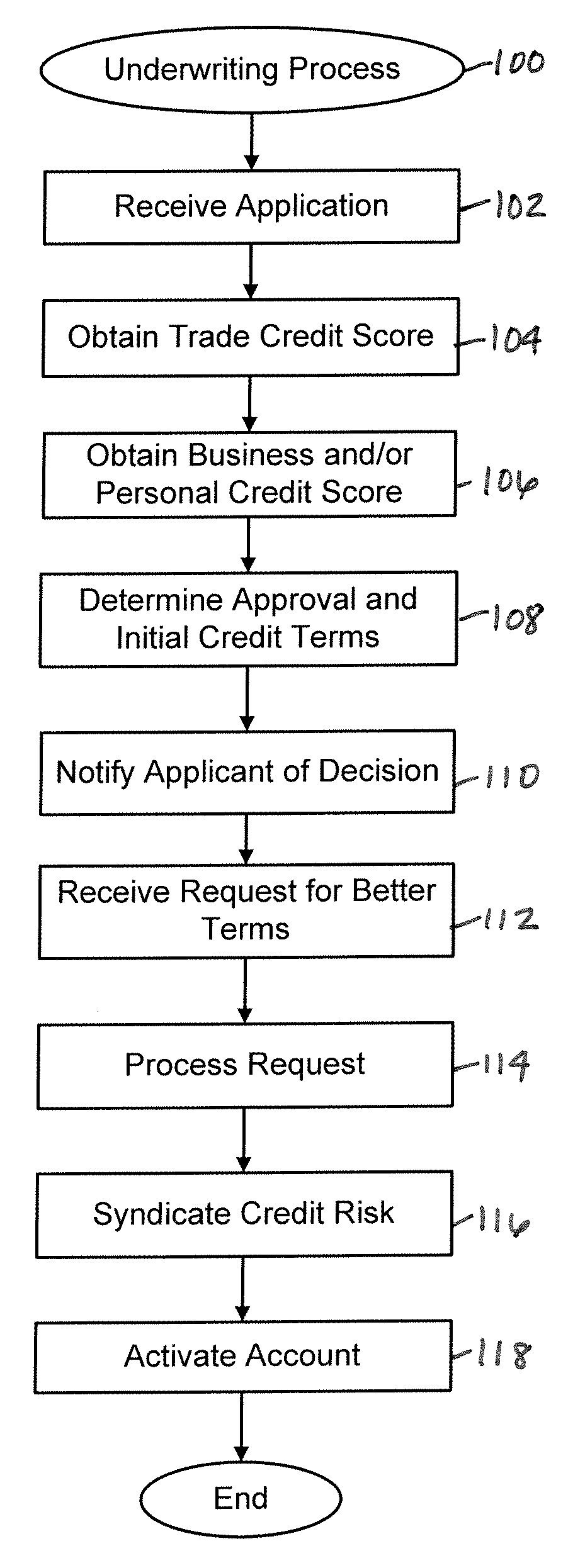

Systems and methods of underwriting business credit

InactiveUS20080177655A1High credit limitFavorable and flexible credit termFinanceCredit limitData science

Various embodiments of the present invention provide systems and methods for underwriting an unsecured line of credit for a buyer using a buyer's trade credit score, and the unsecured line of credit can be used by the buyer to purchase goods and services from a plurality of sellers. In addition, various embodiments provide systems and methods of automatically approving higher credit limits for unsecured lines of credit as compared to known credit cards by considering the trade credit scores and the merits of the buyer's business. Furthermore, various embodiments provide negotiating flexibility for credit terms depending on the extent to which one or more sellers are willing to take on a portion of the risks associated with the line of credit or fund at least a portion of the costs of one or more credit terms associated with the line of credit.

Owner:ZALIK DAVID

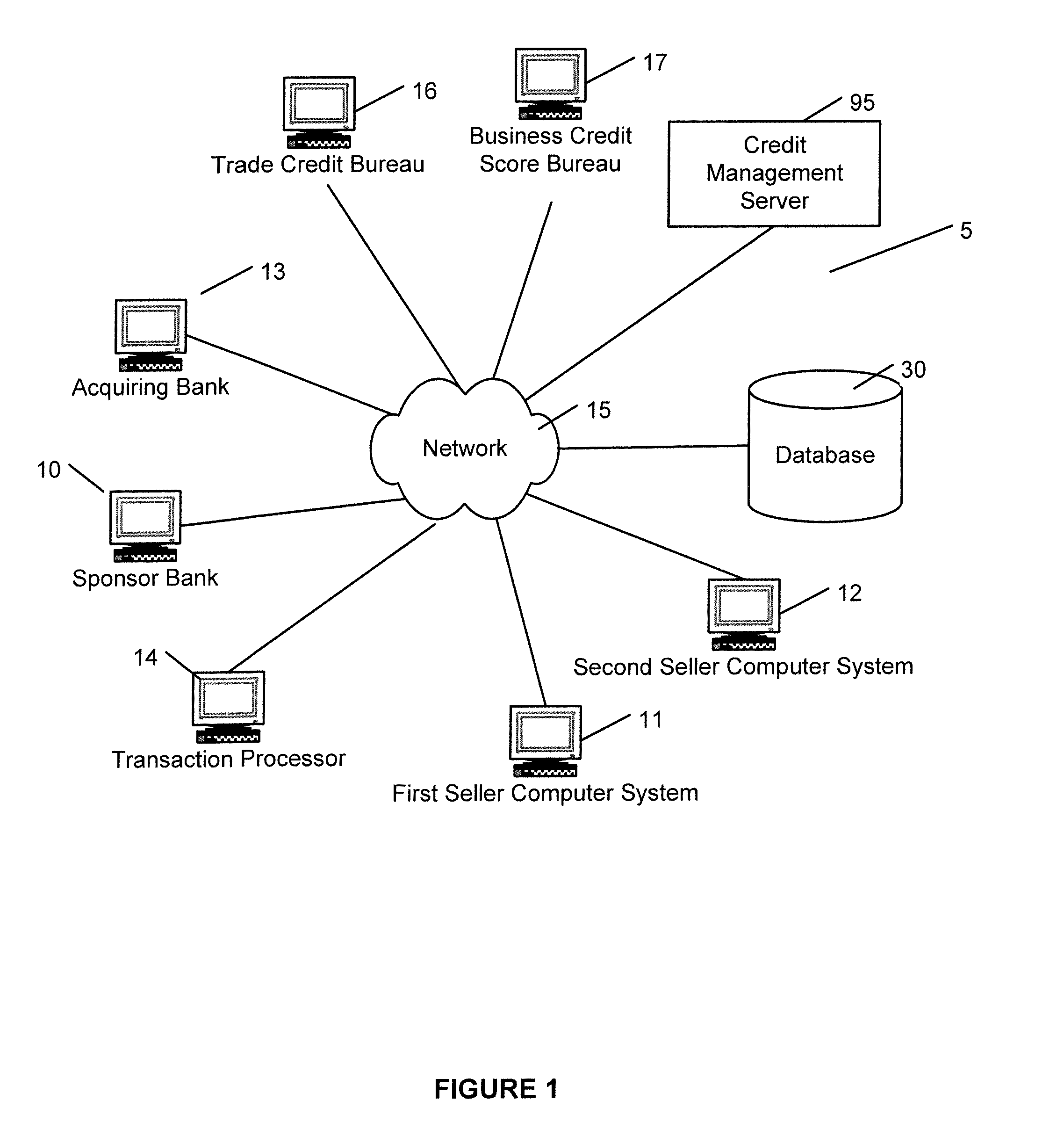

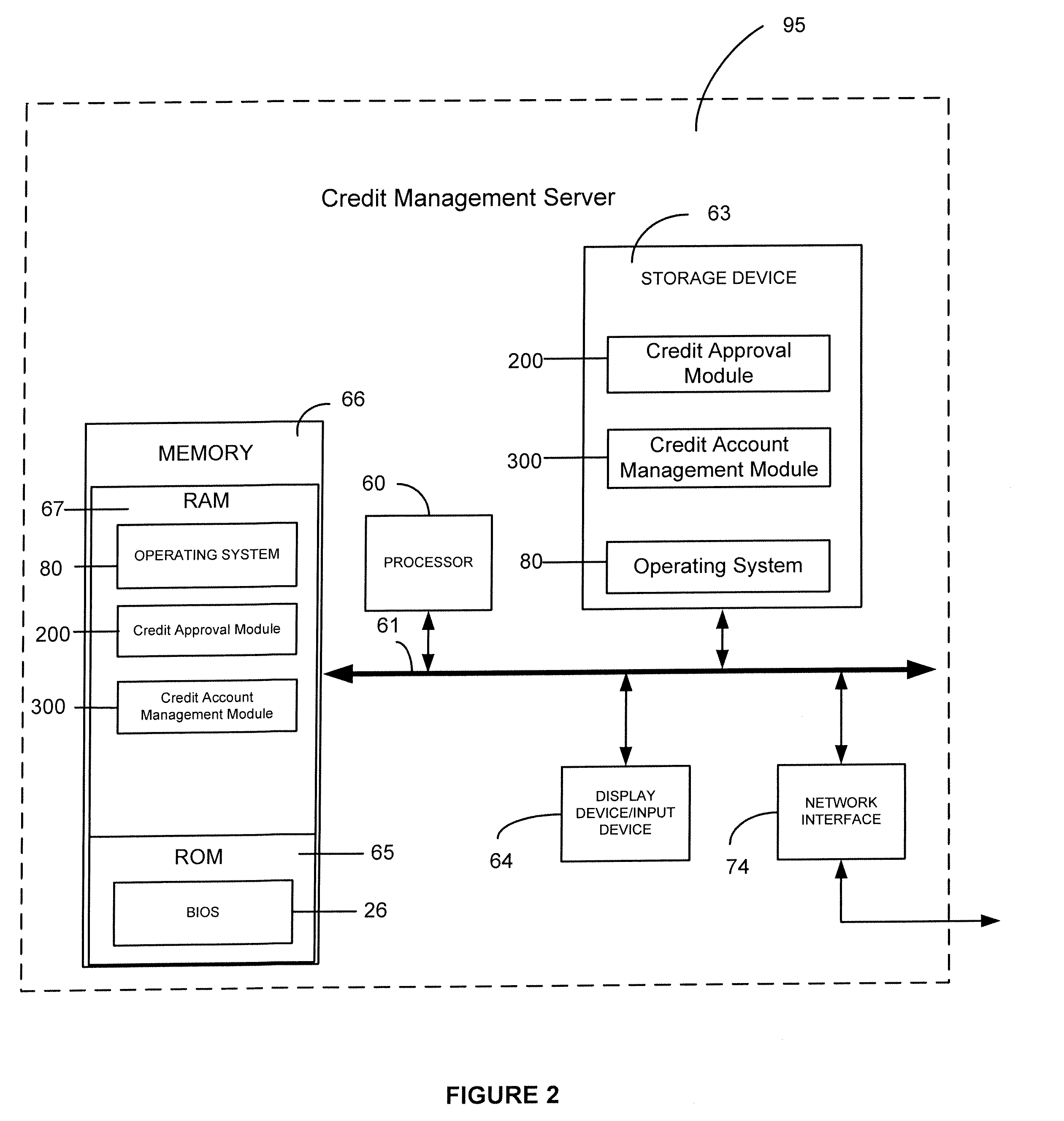

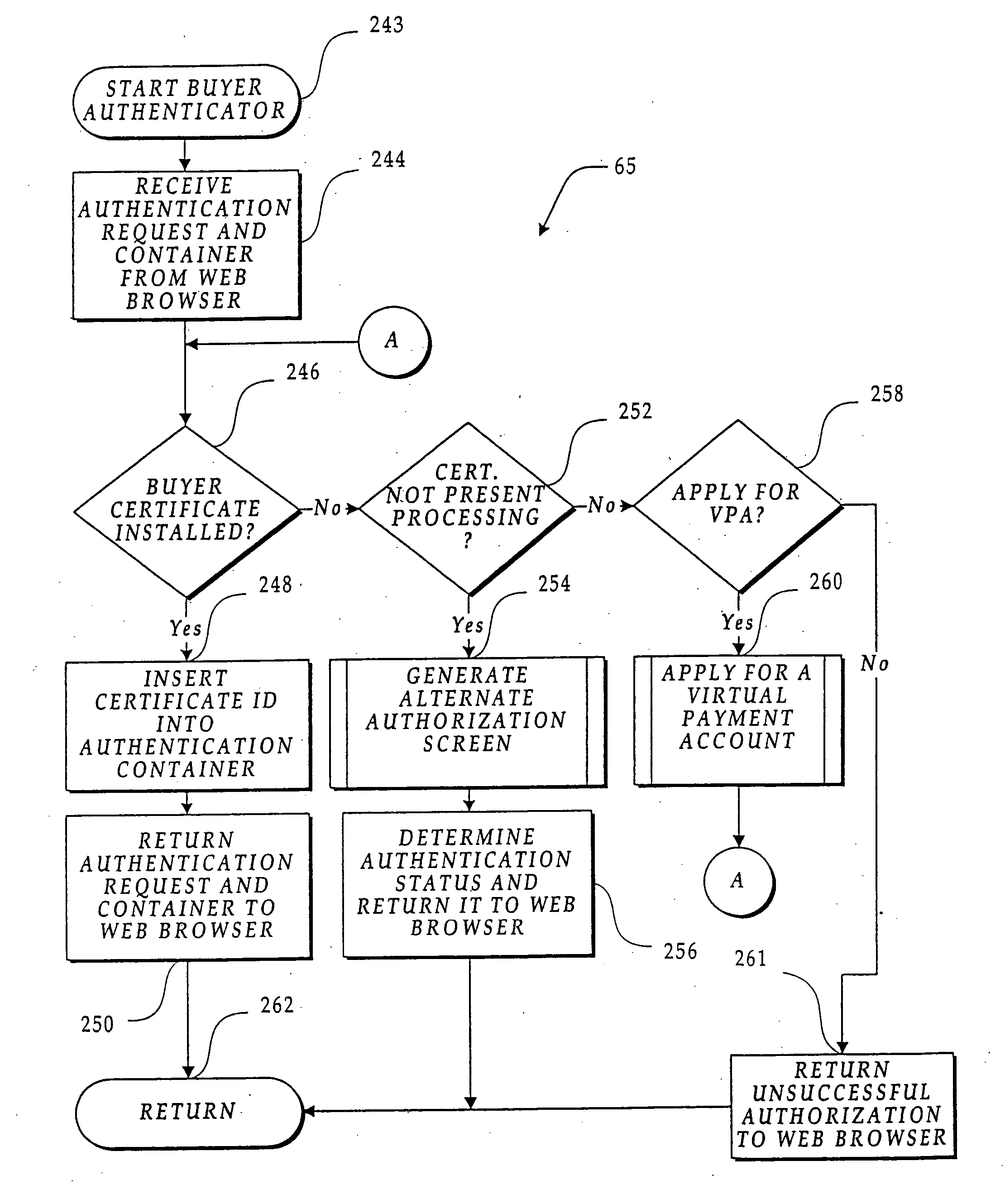

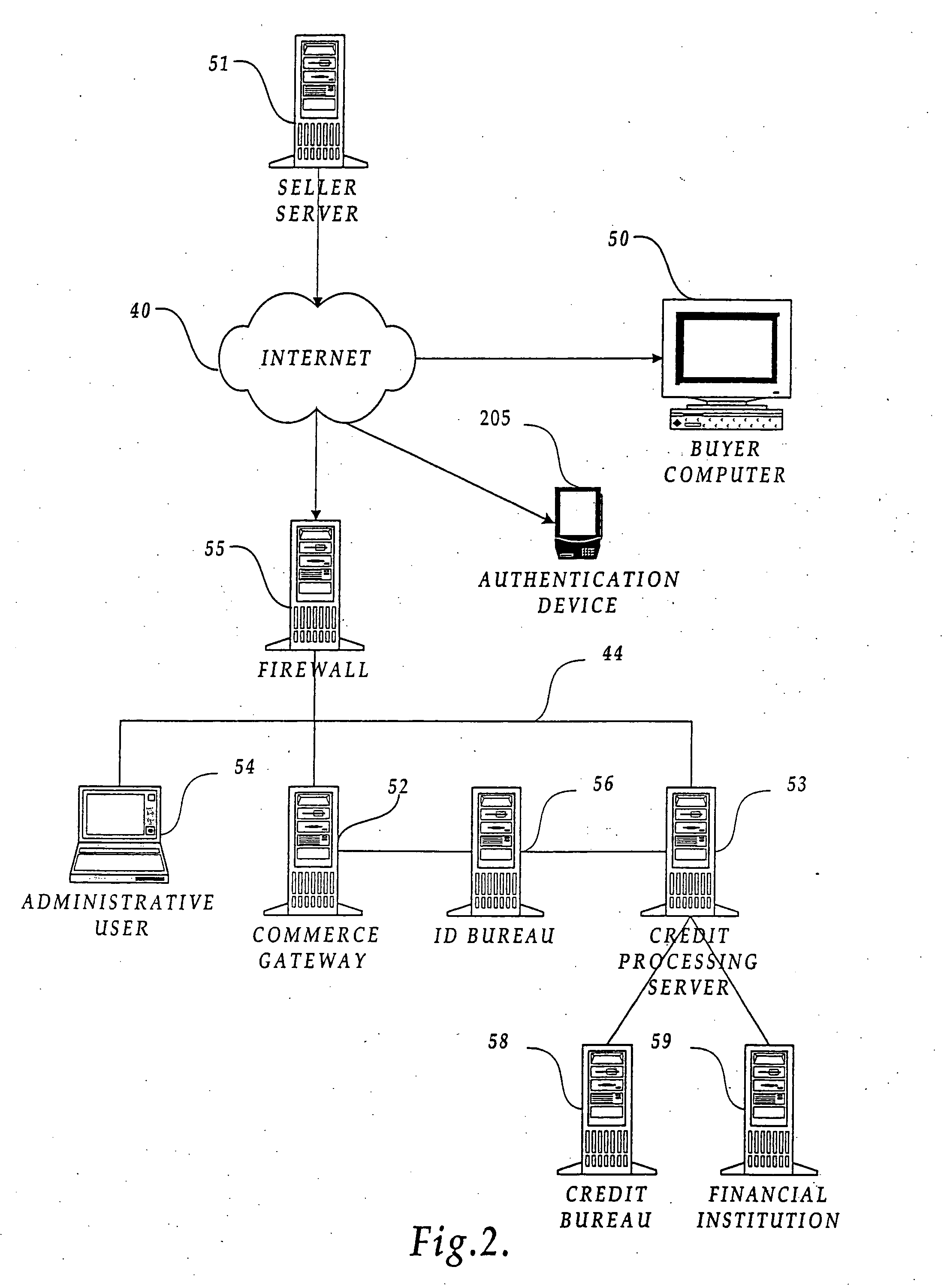

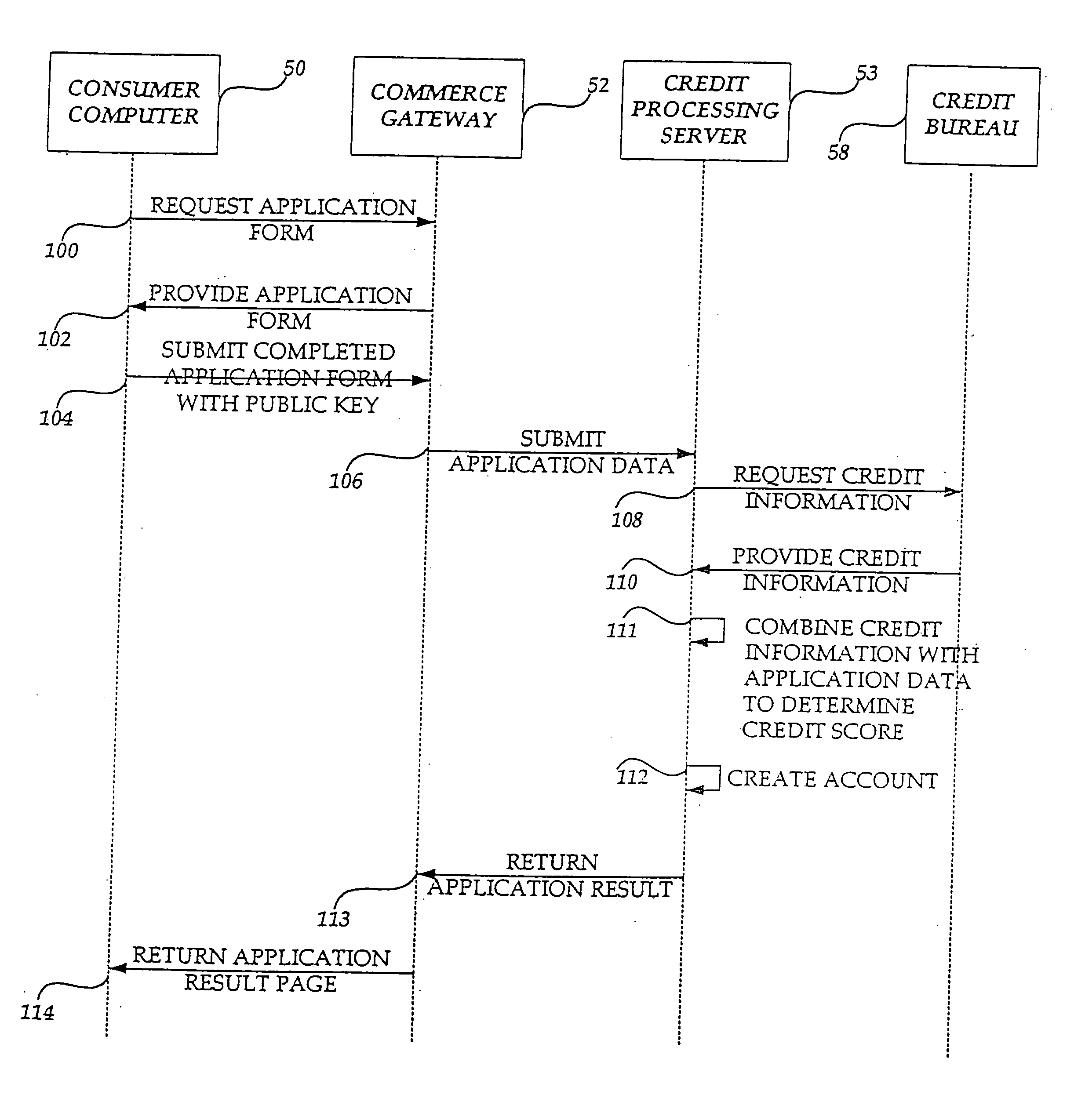

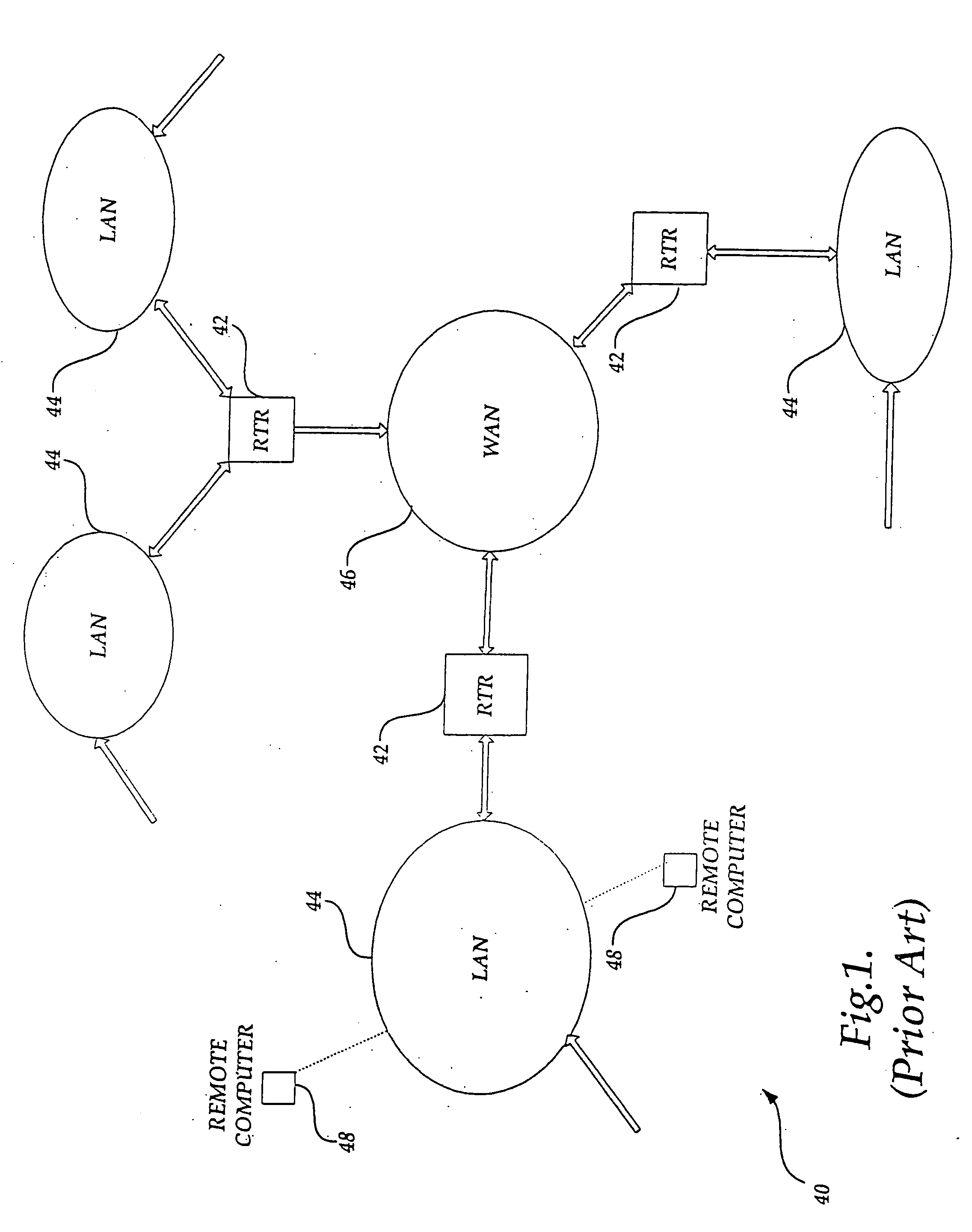

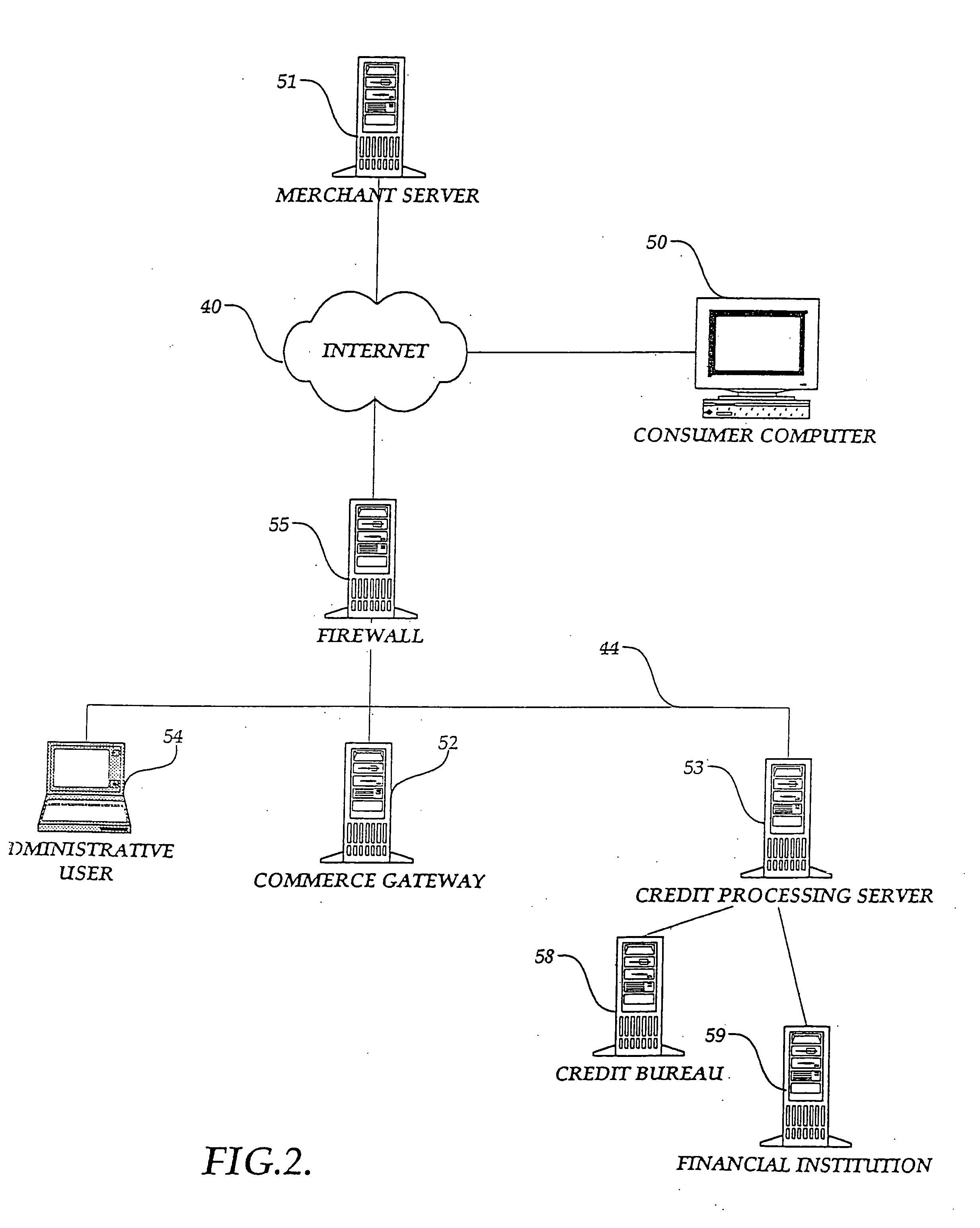

Method and apparatus for ordering goods, services and content over an internetwork using a virtual payment account

A virtual payment system for ordering and paying for goods, services and content over an internetwork is disclosed. The virtual payment system comprises a commerce gateway component (52) and a credit processing server component (53). The virtual payment system is a secure, closed system comprising registered sellers and buyers. A buyer becomes a registered participant by applying for a virtual payment account. Likewise, a seller becomes registered by applying for a seller account. A buyer can instantly open an account on-line. That is, the credit processing component (53) immediately evaluates the buyer's virtual payment card application and assigns a credit limit to the account. Once an account is established, a digital certificate is stored on the registered participant's computer. The buyer can then order a product, i.e., goods, services or content from a seller and charge it to the virtual payment account. When the product is shipped, the seller notifies the commerce gateway component (52), which in turn notifies the credit processing server that applies the charges to the buyer's virtual payment account. The buyer can settle the charges using a prepaid account, a credit account, or by using reward points earned through use of the virtual payment card. A buyer may create sub-accounts that have additional limitations imposed on the owners of the sub-accounts.

Owner:STRIPE INC

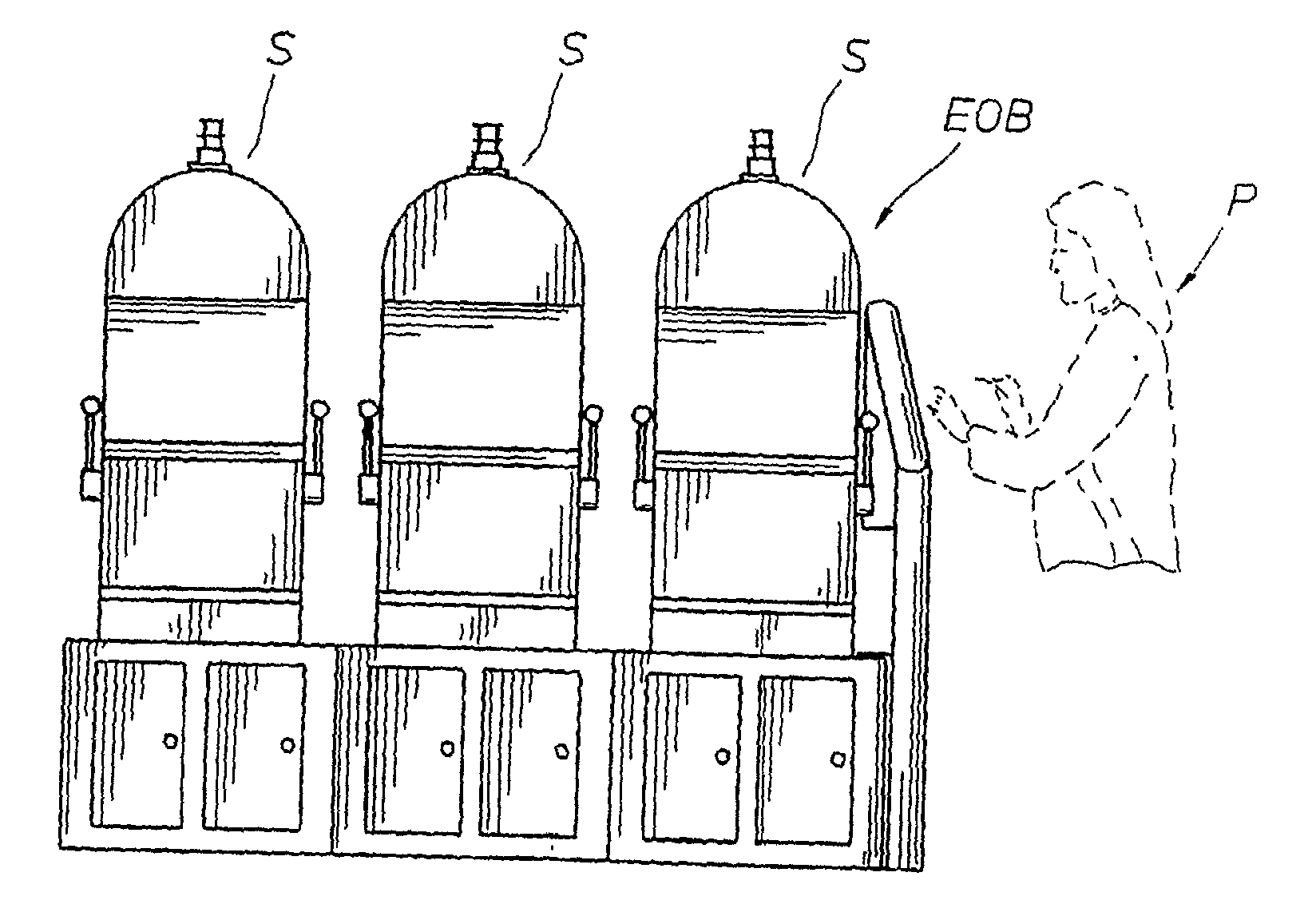

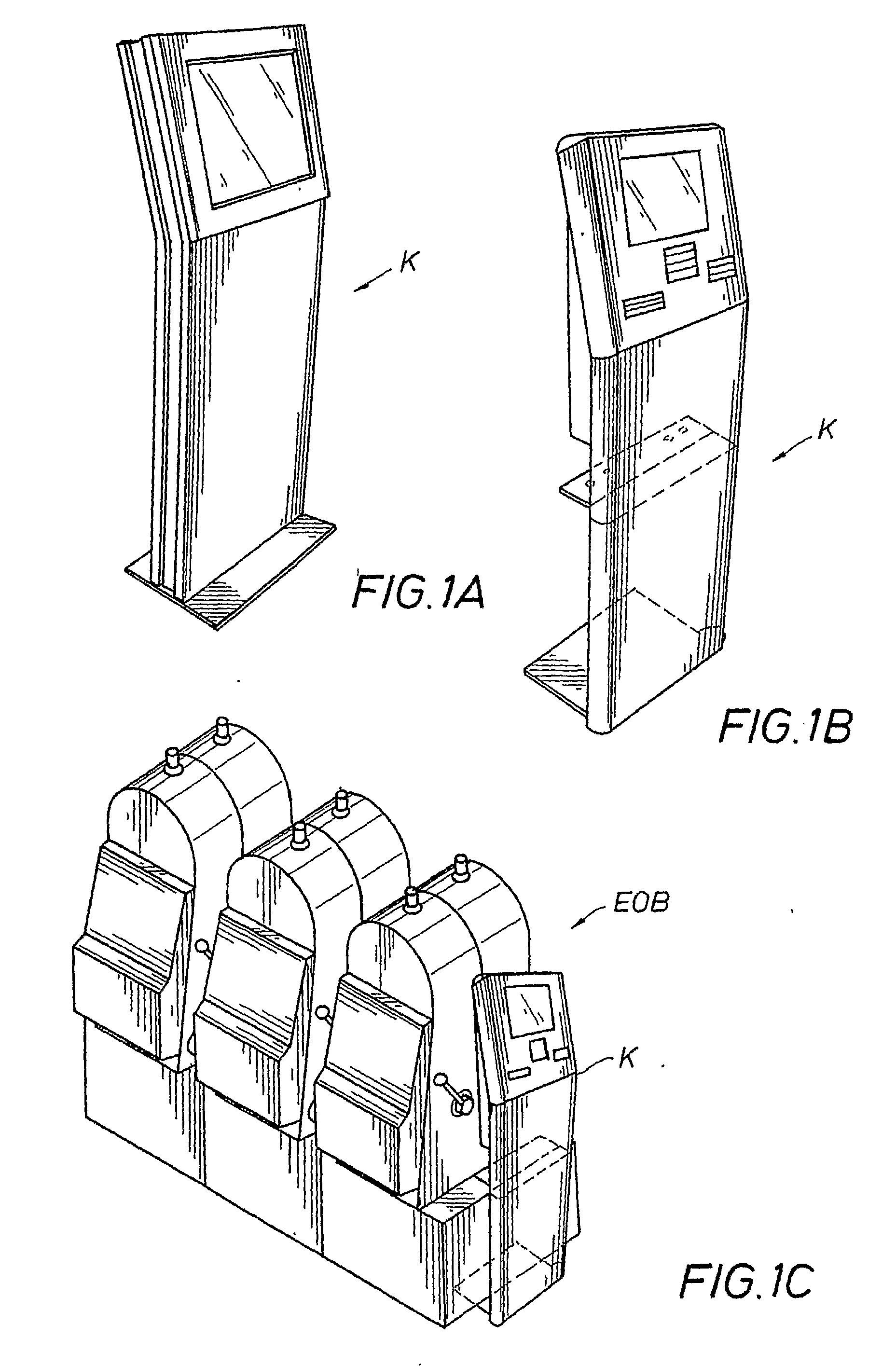

Systems for Enhancing Funding of Gaming

ActiveUS20100222132A1Targeted optimizationMaximize versatilityPayment architectureApparatus for meter-controlled dispensingProximateVoucher

Apparatus and method for facilitating the funding of gaming and preferably the purchase of gaming vouchers (slot vouchers) with commercial bank cards and / or with casino and / or new credit accounts (private label and / or affiliate / Networking permanent or temporary) and / or the prompting of opening of a new credit account, including an automated kiosk located on a gaming floor proximate to gaming machines but separate from particular gaming machines, and including method and apparatus for the purchase and redemption of vouchers at a gaming table, including reading and printing equipment in communication with a voucher host; also including a prompt to open new a gaming oriented line of credit, associated with a refusal of an EFT transaction, preferably a credit / debit card cash advance request, and including a preferred gaming oriented credit card account and card (private label and / or affiliate / Networking permanent or temporary) (including a patron selection coded card) having cash advance limits commensurate with credit limits for gaming oriented transactions and wherein a cash advance can be secured within an hour after the opening and approval of the account, the approval of the account preferably based on EFT gaming transaction history.

Owner:EVERI PAYMENTS

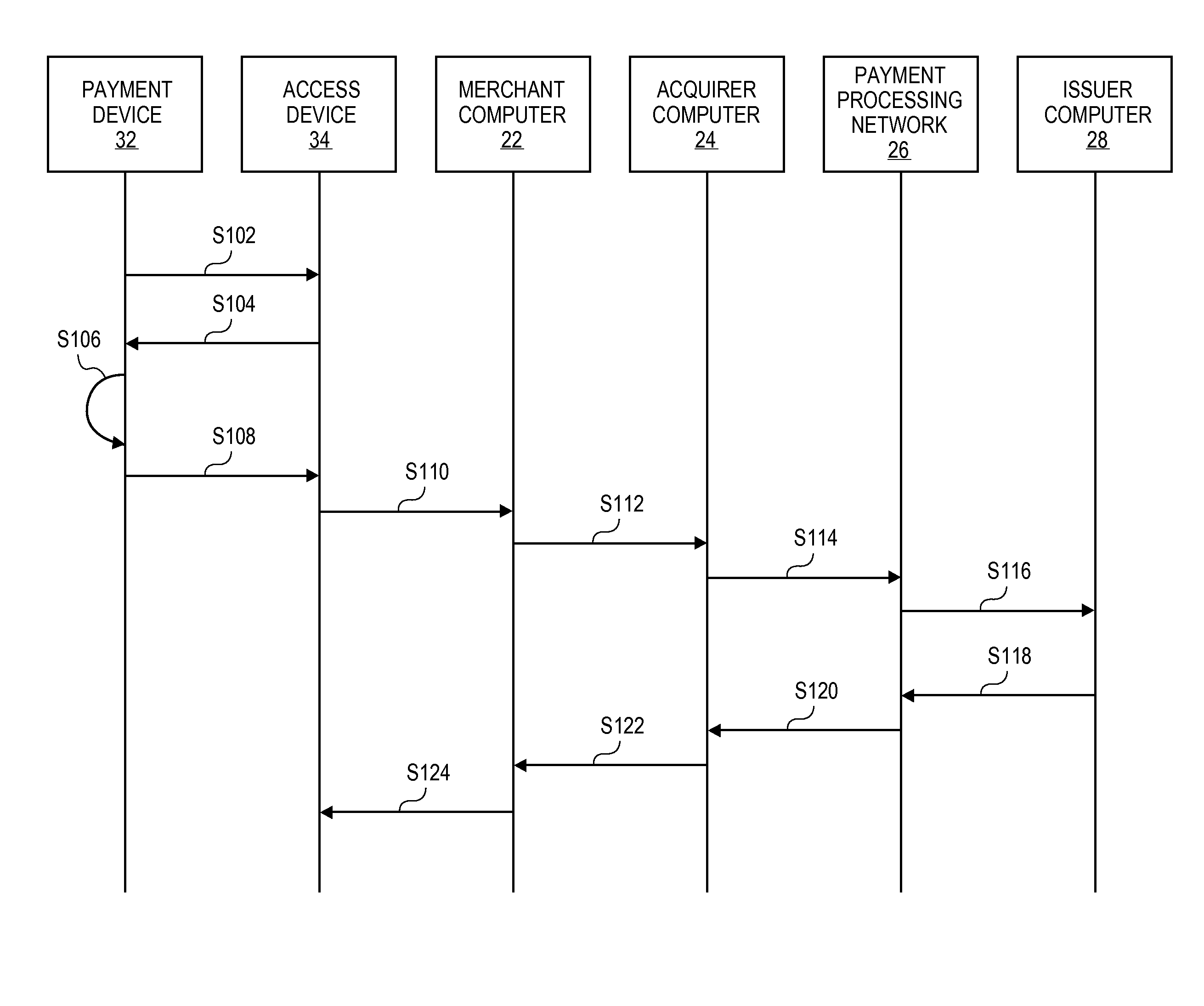

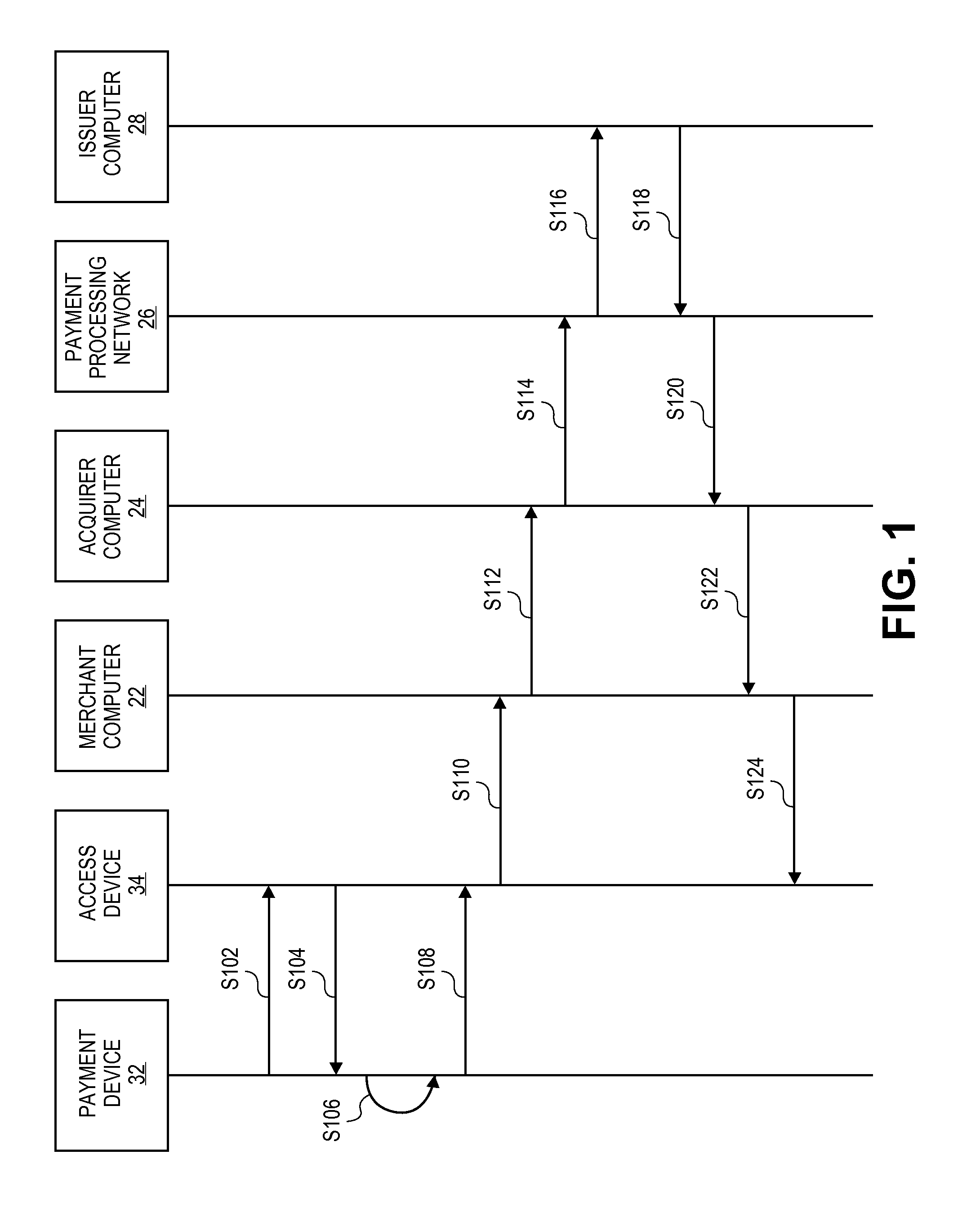

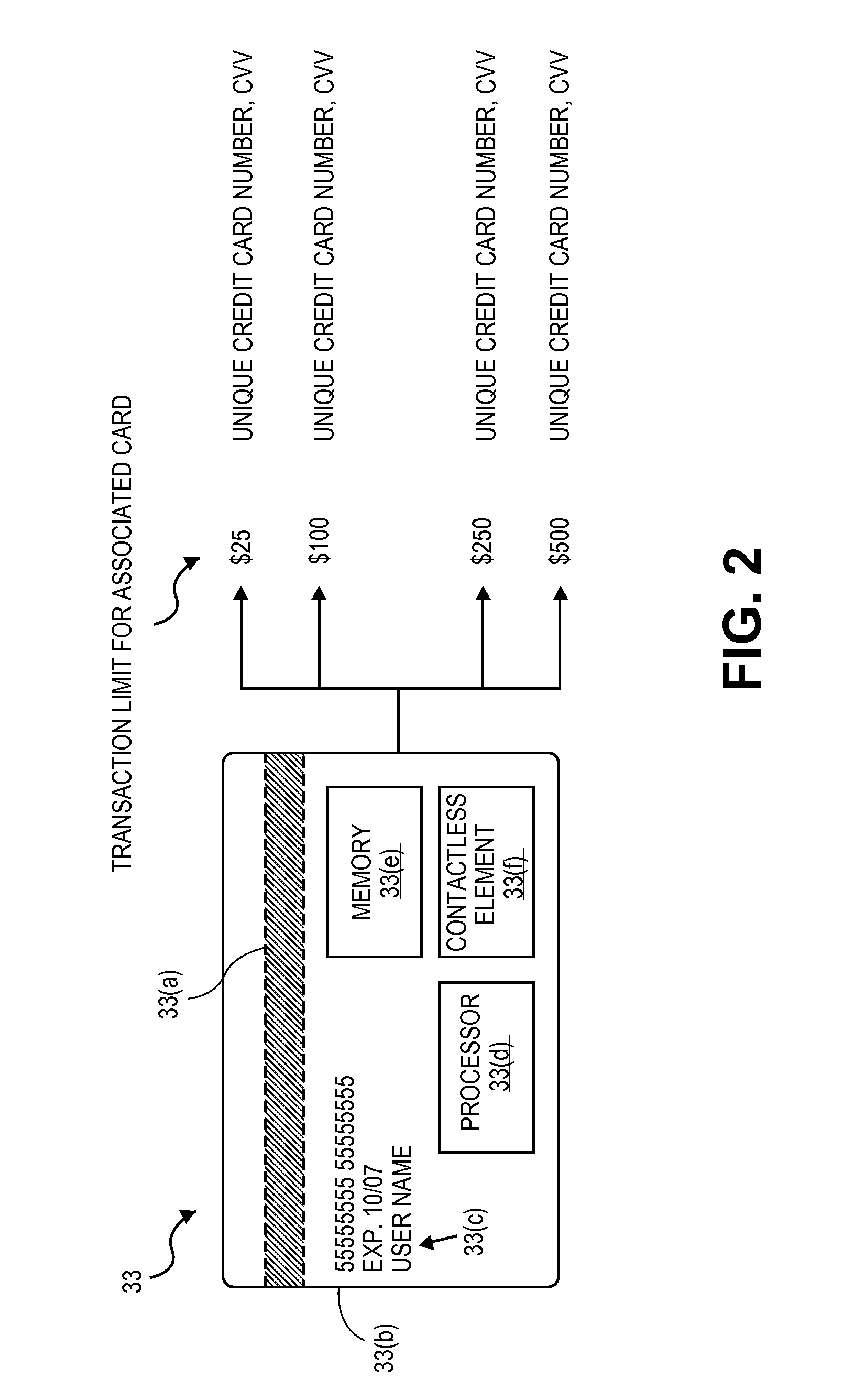

Dynamic Account Selection

Embodiments automatically select one of the multiple pre-generated payment cards provisioned on a mobile device. The multiple pre-generated payment cards (real or virtual) may each have a different credit limit. The mobile device may automatically select one of the multiple payment cards based on a transaction value of a transaction that is being conducted. An available credit limit of the selected payment card may be equal to or slightly greater than the transaction value. In some embodiments, the available credit limit of the selected payment card may be closer to the transaction value than the available credit limits of the remaining payment cards. In some embodiments, the different payment cards may be provisioned in a chip-and-pin based smart credit card or mobile wallet.

Owner:VISA INT SERVICE ASSOC

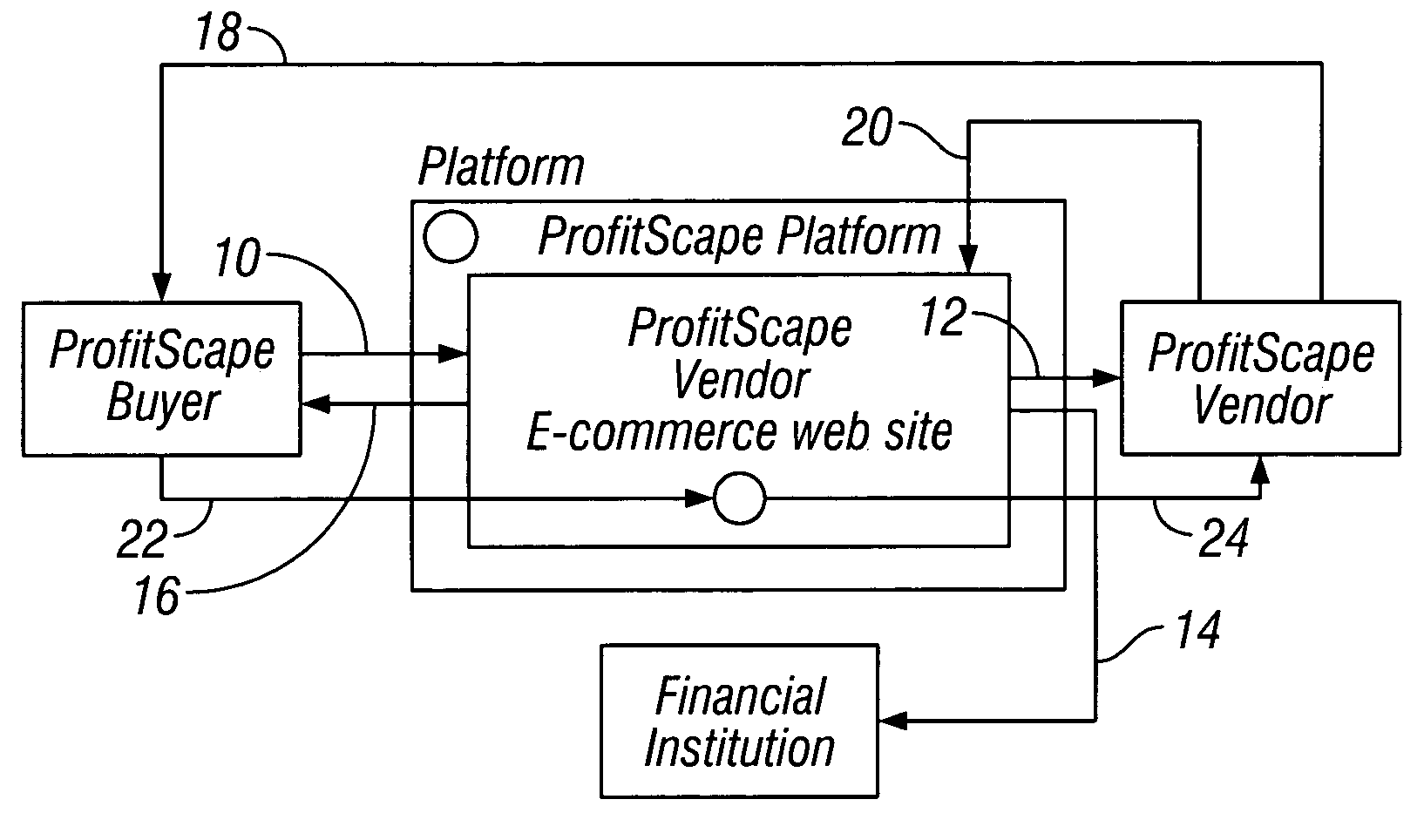

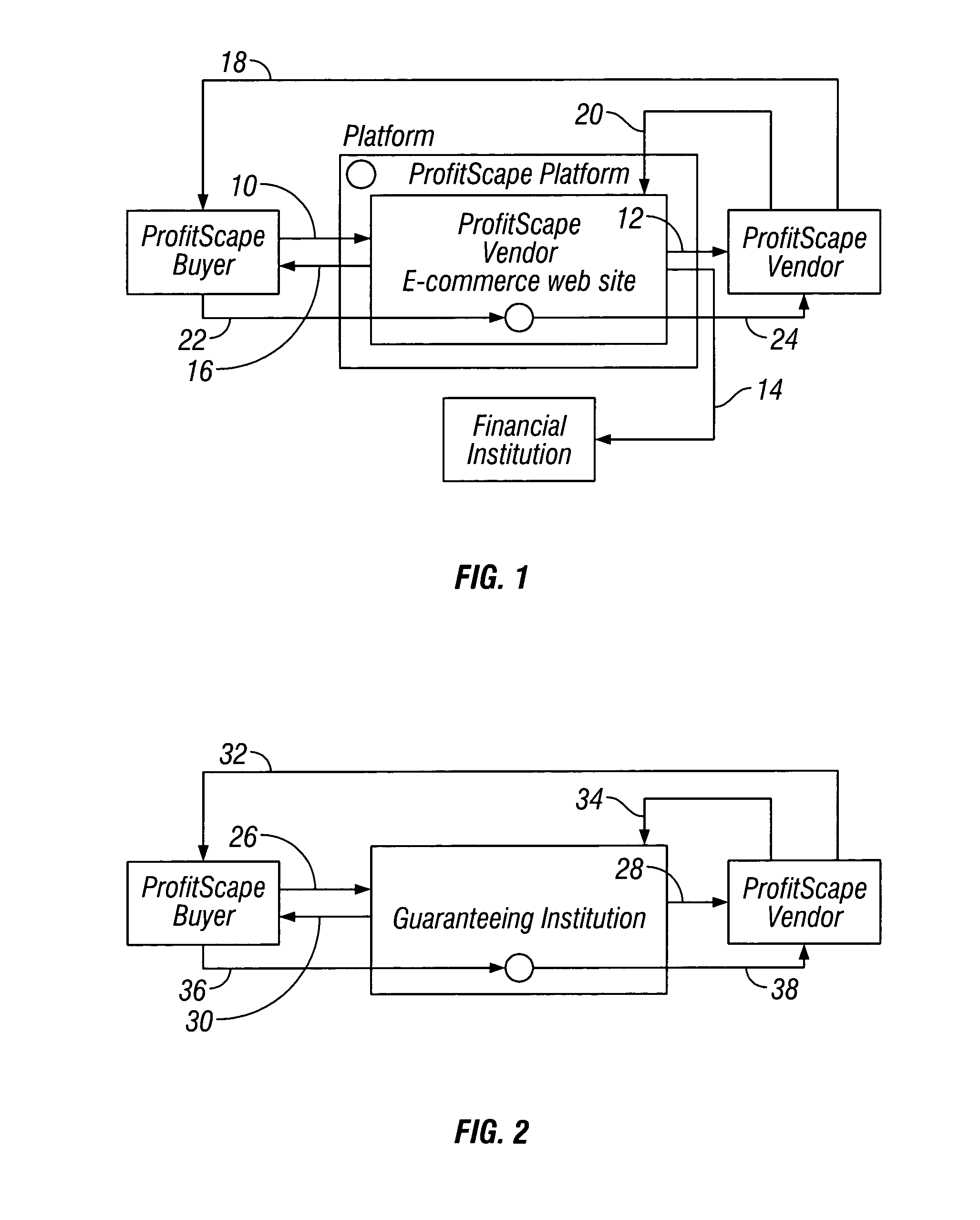

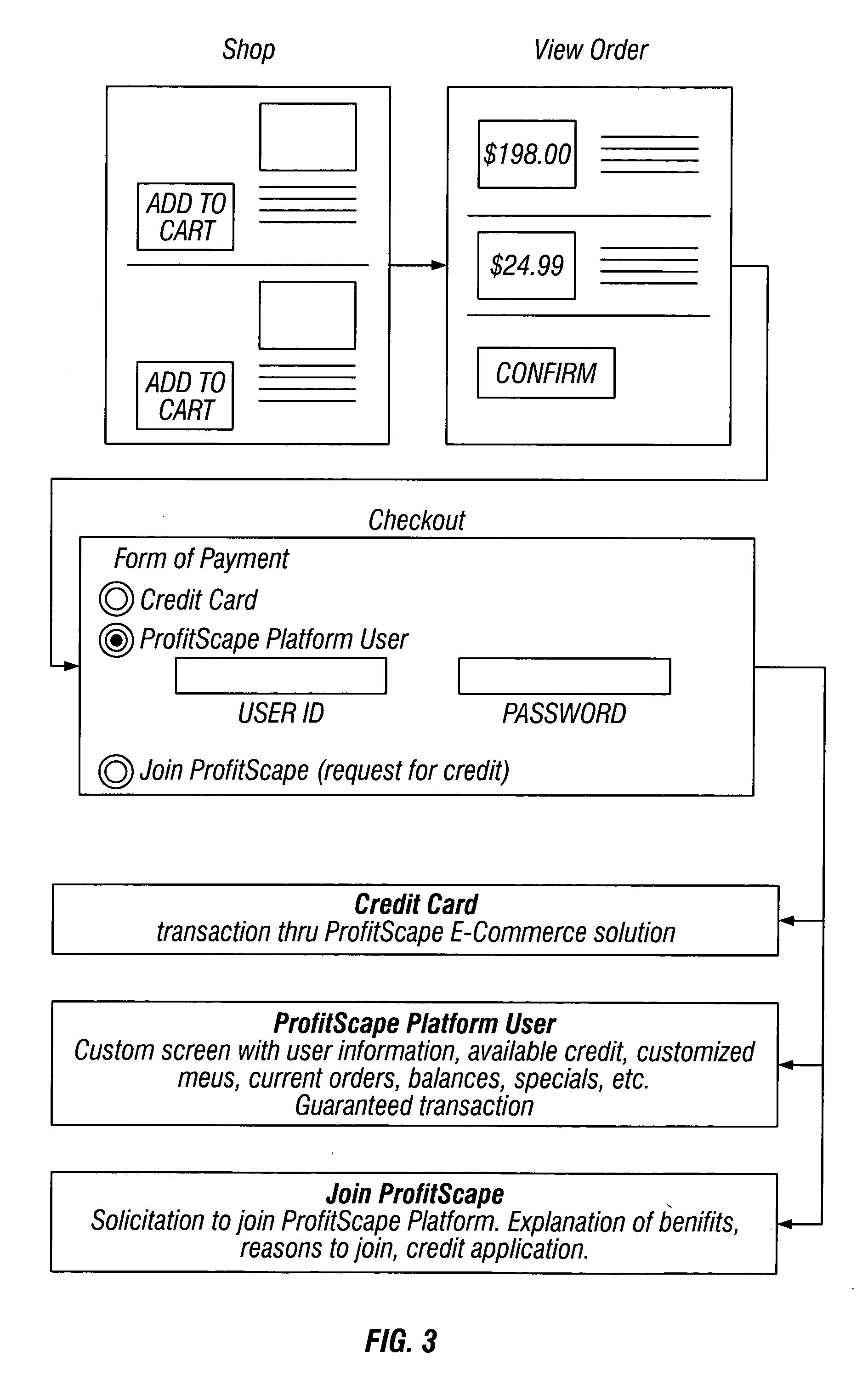

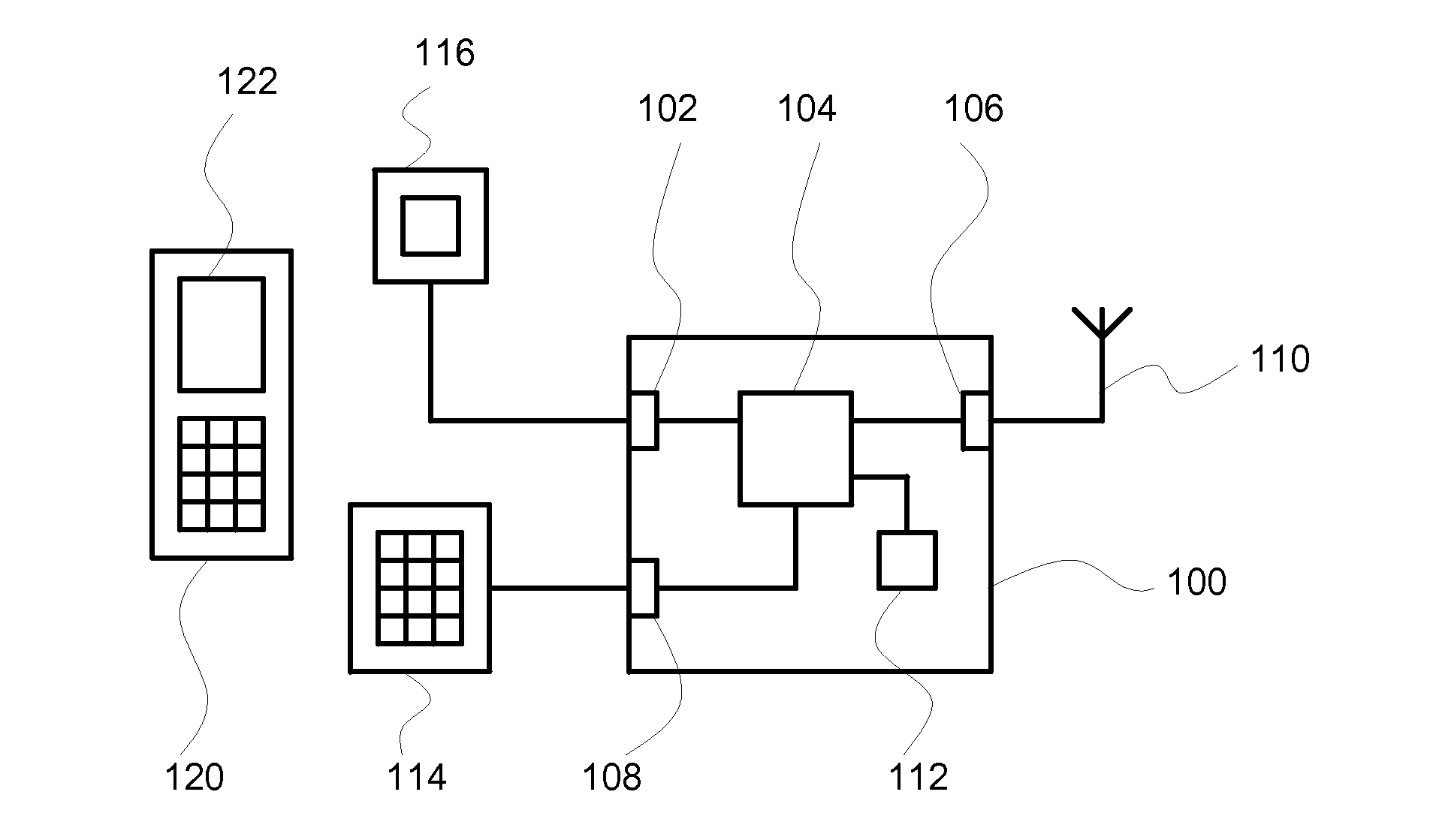

Electronic factoring

The present invention is a method and system for electronic factoring. An electronic platform is provided for guaranteeing payment of receivables. Information from users is input into a profile database upon the electronic platform and is accessible by all users. The buyers are assigned a credit limit and are able to purchase from vendors within that credit limit. The payments for these purchases are guaranteed by a guaranteeing financial institution with is aligned with the platform.

Owner:PROFITSCAPE +1

Payment transaction client, server and system

InactiveUS20120150737A1Eliminate needLow implementation costFinancePoint-of-sale network systemsPayment transactionBarcode

The invention relates to a system for handling payment transactions, comprising a payment transaction client and a payment transaction server. A customer identifies himself by providing a code to a shop, preferably by a bar code. The shop sends customer identification, shop identification, client identification and the amount to the server. The server looks up further customer information, checks the balance on the account of customer and issues a payment confirmation code to the mobile telephone of the customer if the customer has enough credit on the account. The customer provides the code to the shop or directly to the client, upon which the client sends the payment confirmation code and further information like the information sent previously to the server. If the confirmation code received matches the confirmation code issues early, the server executes the payment or instructs a bank to execute the payment.

Owner:EURO WALLET

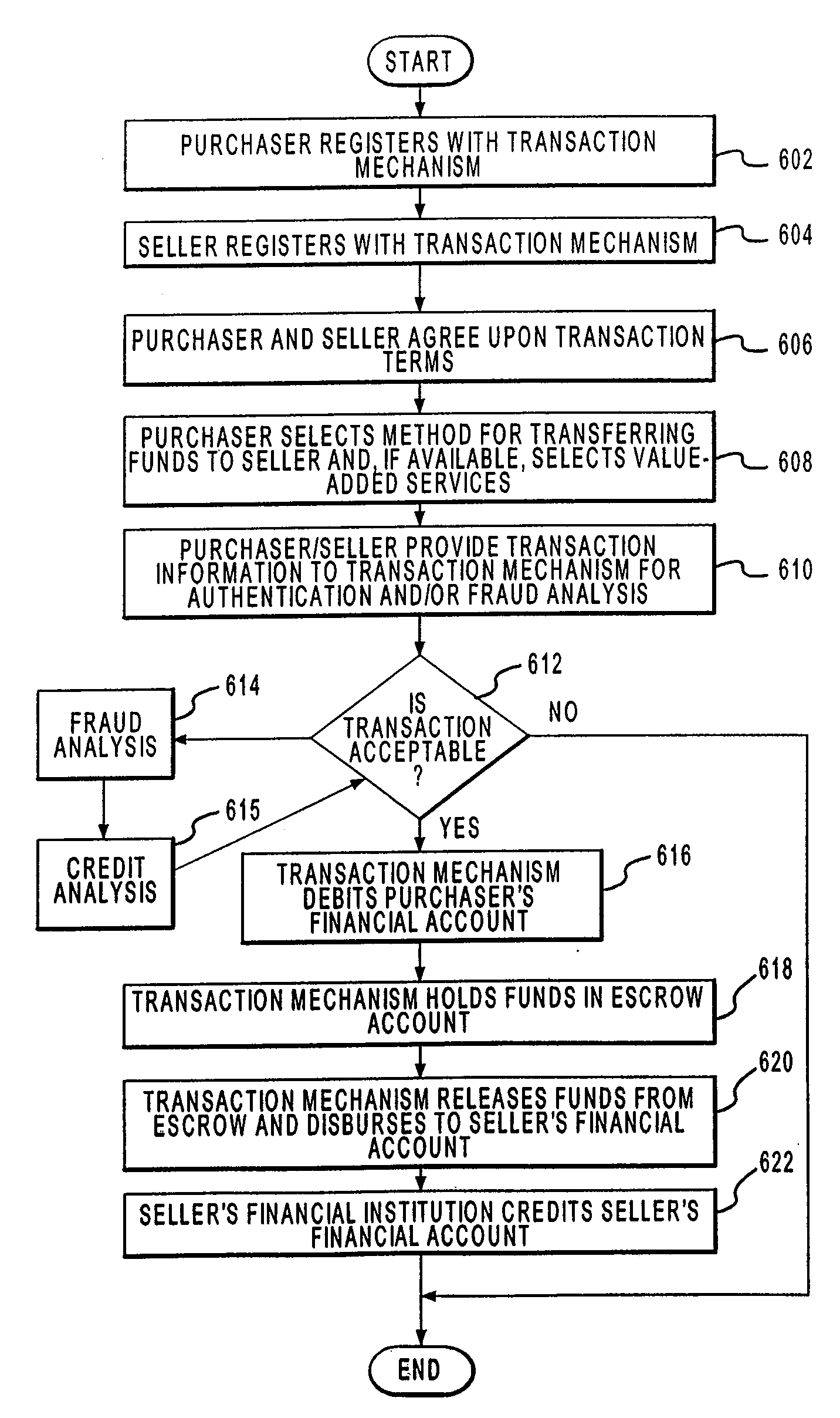

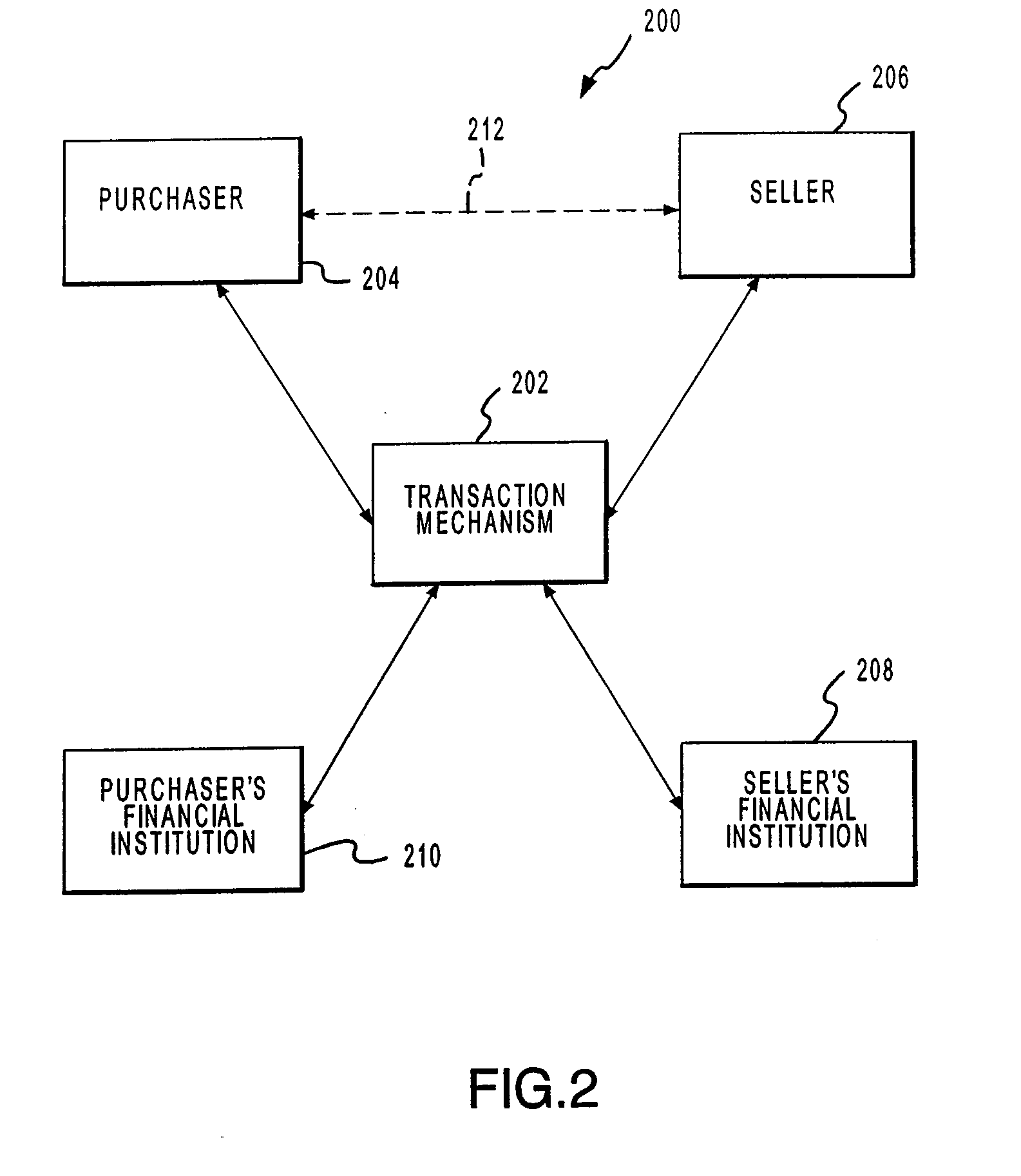

Systems and methods for facilitating transactions with interest

InactiveUS20090048963A1Increase purchase intentionConvenient transactionFinanceCommerceProof-of-paymentInternet privacy

A financial account issuer facilitating transactions between accounts is disclosed. The invention provides sellers with an irrevocable method of receiving funds from a purchaser and for improving purchaser willingness to transact with an unknown party. The invention also includes the options of interest payments, the use of different account issuers, different financial accounts, budget transfers, spend compartmentalization, cost-splitting, adjusting credit limits, loans, gifting, intermediary facilitating the transaction, transaction tracking, rapid funds availability, confidential transfer of funds, immediate initiation of shipment by a seller, releasing funds to a seller only after approval of the goods, services, or other value, demonstrating proof of payment, and recourse against a remote seller.

Owner:LIBERTY PEAK VENTURES LLC

Method and apparatus for ordering goods, services and content over an internetwork using a virtual payment account

A virtual payment card system for ordering and paying for goods, services and content over an internetwork is disclosed. The virtual payment card system comprises a commerce gateway component (52) and a credit processing server component (53). The virtual payment card system is a secure closed system comprising registered merchants and consumers. A consumer becomes a registered participant by applying for a virtual payment card. Likewise, a merchant becomes registered by applying for a merchant account. A consumer can instantly open an account on-line. That is, the credit processing component (53) immediately evaluates the consumer's virtual payment card application and assigns a credit limit to the account. Once an account is established, a digital certificate is stored on the registered participant's computer. The consumer can then order a product, i.e., goods, services or content from a merchant and charge it to the virtual payment card. When the product is shipped, the merchant notifies the commerce gateway component (52), which in turn notifies the credit processing server which applies the charges to the consumer's virtual card account. The consumer can settle the charges using a prepaid account, a credit card, or by using reward points earned through use of the virtual payment card. A consumer may create sub-account that have additional limitations imposed on the owner of the sub-account.

Owner:STRIPE INC

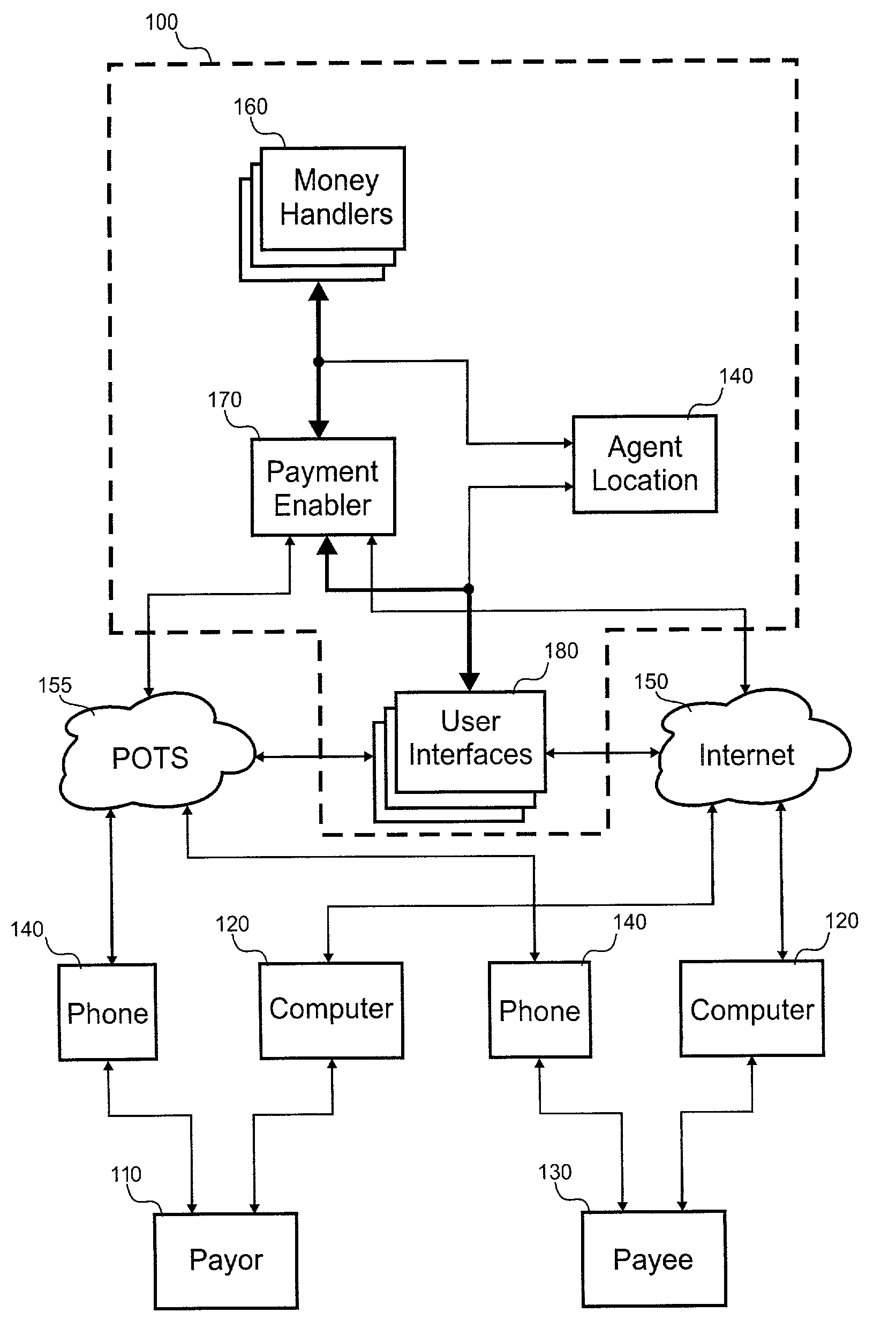

Automated group payment

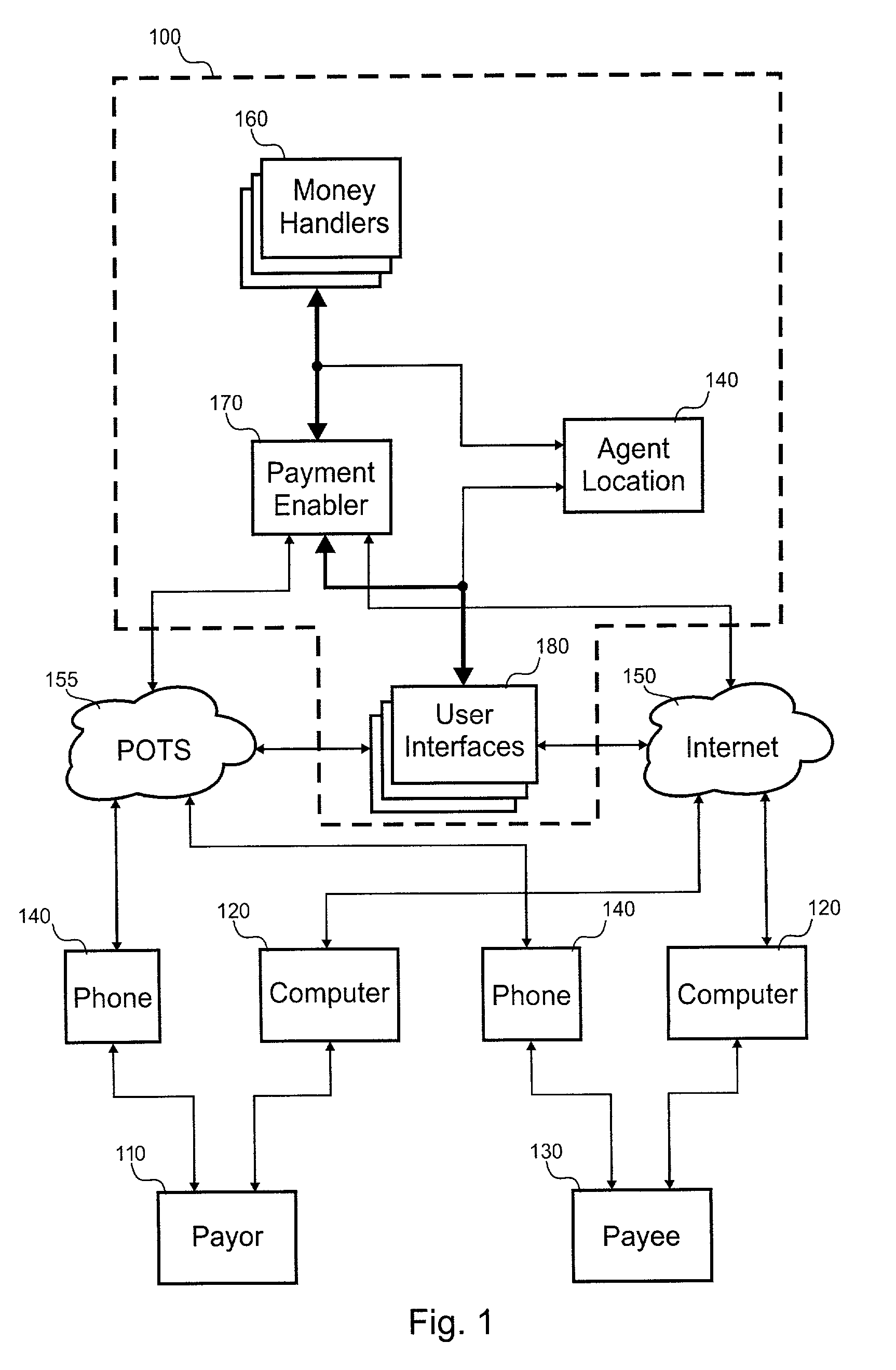

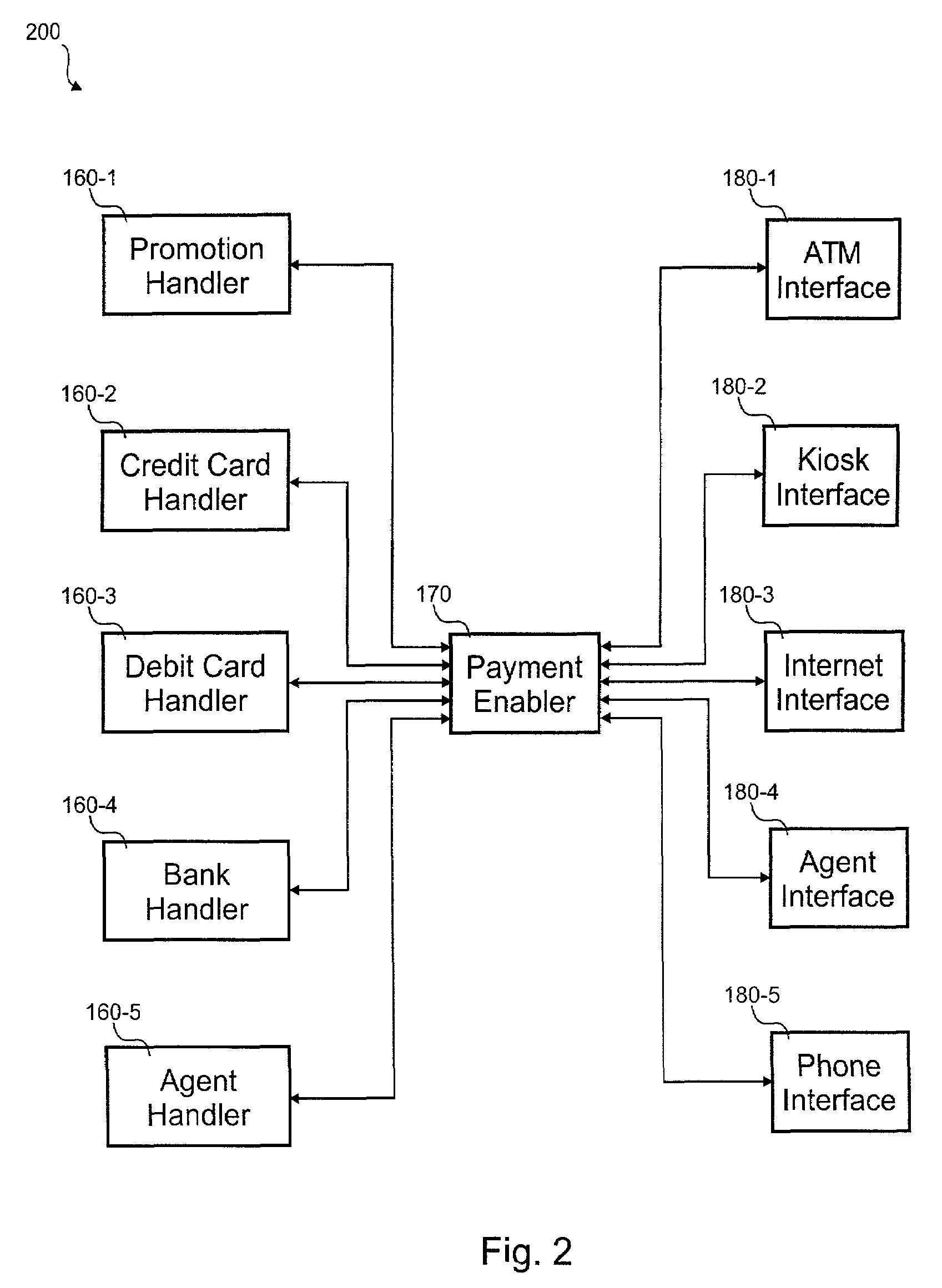

According to the invention, a process for transferring credit from a sender to a number of recipients using a wide-area computer network is disclosed. In one step, a server computer system receives information from the sender to transfer credit to the number of recipients. The information includes a unique identifier for each of the number of recipients and a credit amount. A first handler chosen by the sender and a second handler chosen by one of the number of recipients are determined. A credit transfer from the first handler is requested. The credit amount from the first handler is received at the server computer system. The credit amount is sent to the second handler associated with the one of the number of recipients.

Owner:THE WESTERN UNION CO +1

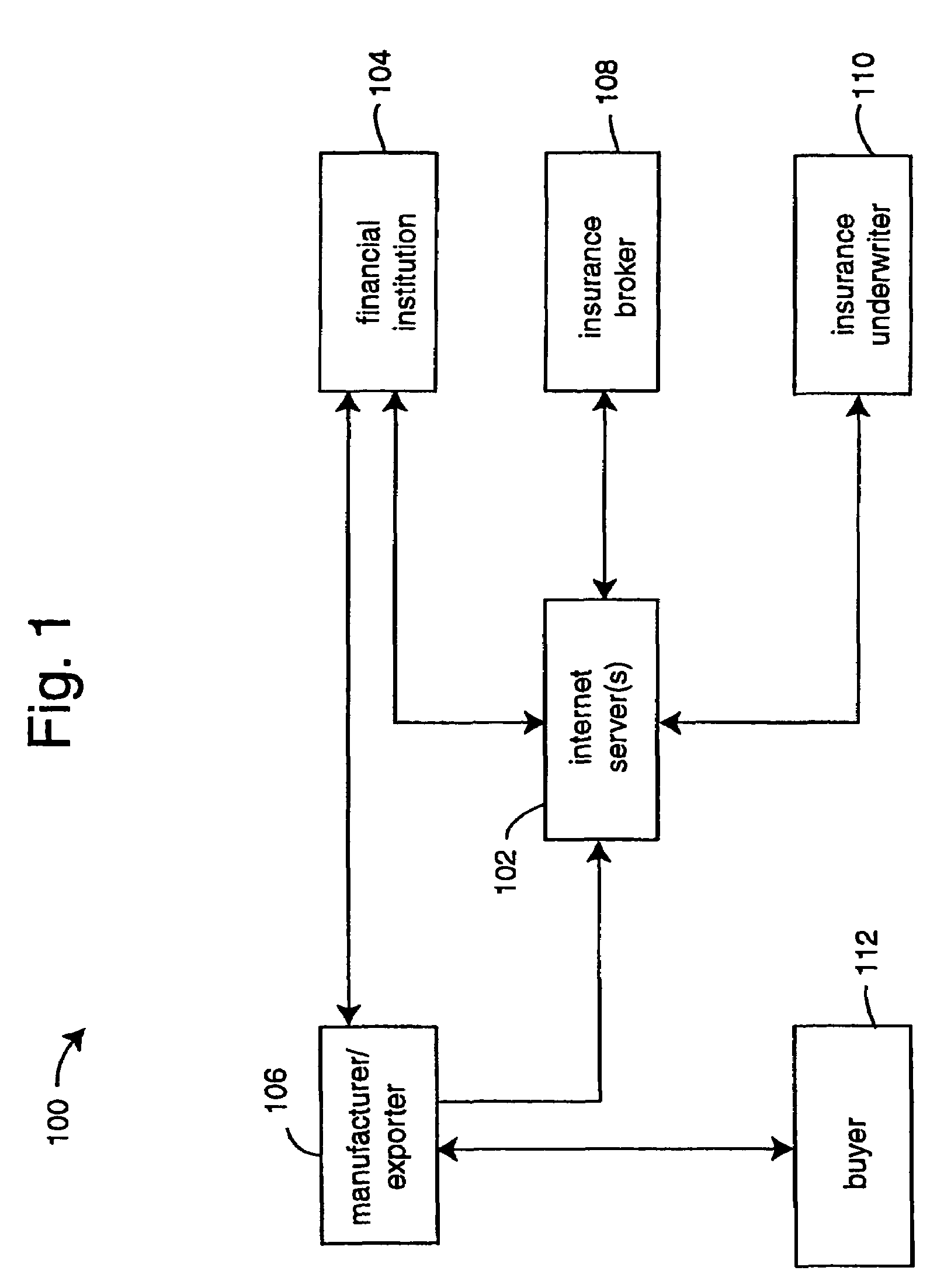

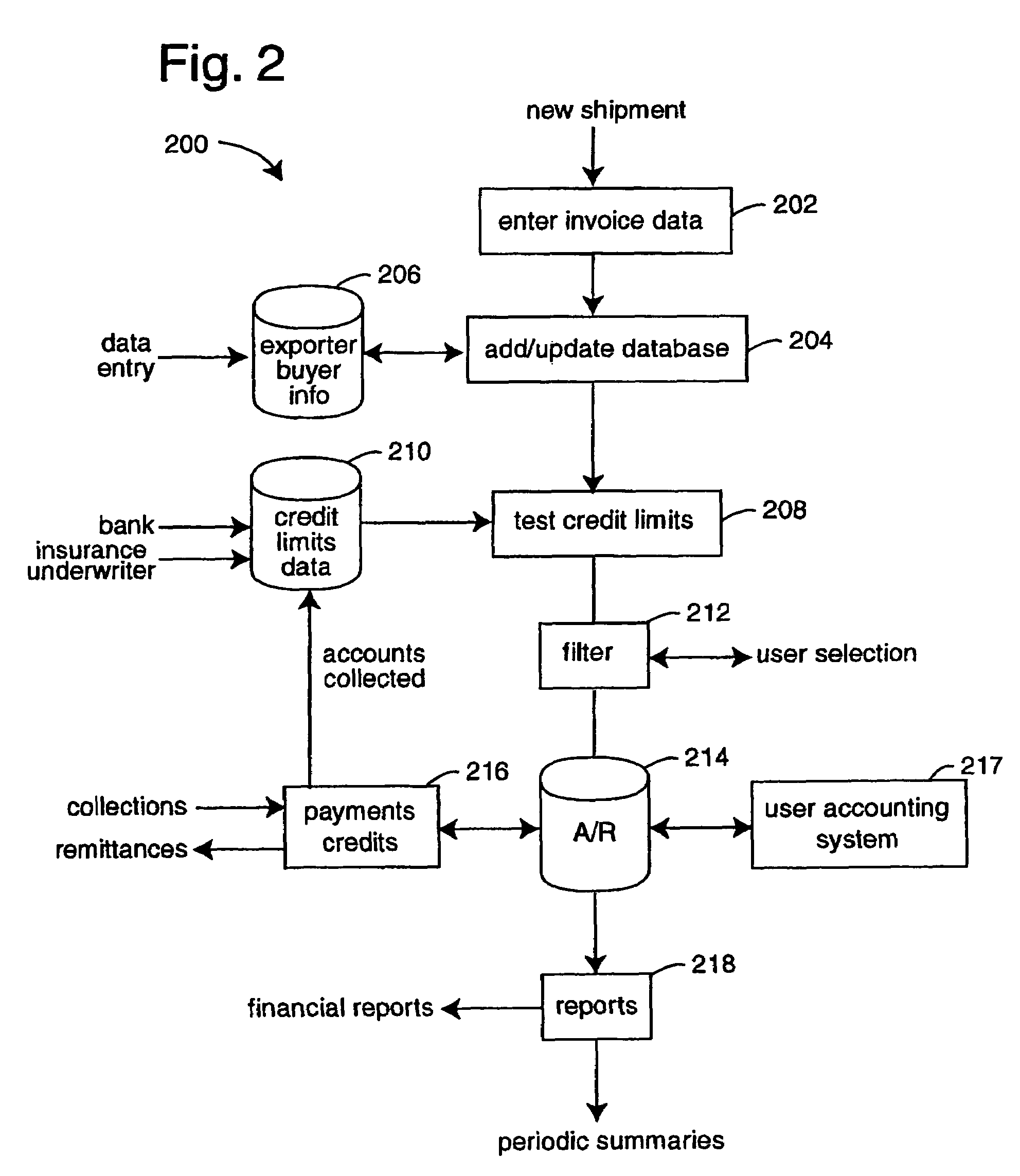

Trade finance automation system

A trade finance automation system includes an accounts receivable database receiving and storing invoices issued by one or more prescribed vendors for sales made to specified buyers. A credit limits database contains various credit limits applicable to buyers' accounts receivables that are subject to existing third party financing, the credit limits dictated by factors including terms of said third party financing. A credit limits tester performs substantially real time checking of buyers' invoices in the accounts receivable database to ensure compliance with the credit limits set forth in the credit limits database for said buyers.

Owner:EXPORT FINANCE SYST

Credit manager method and system

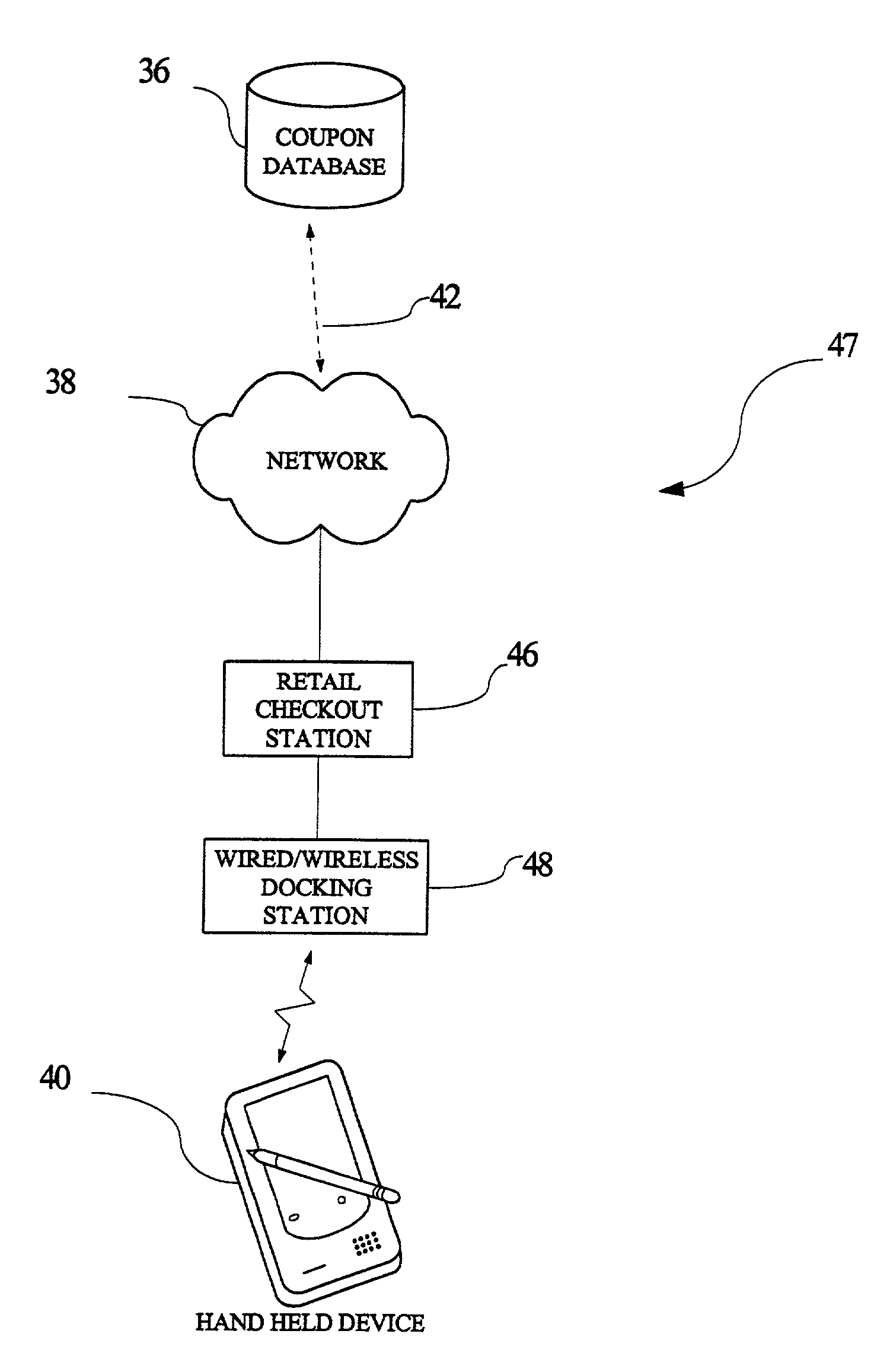

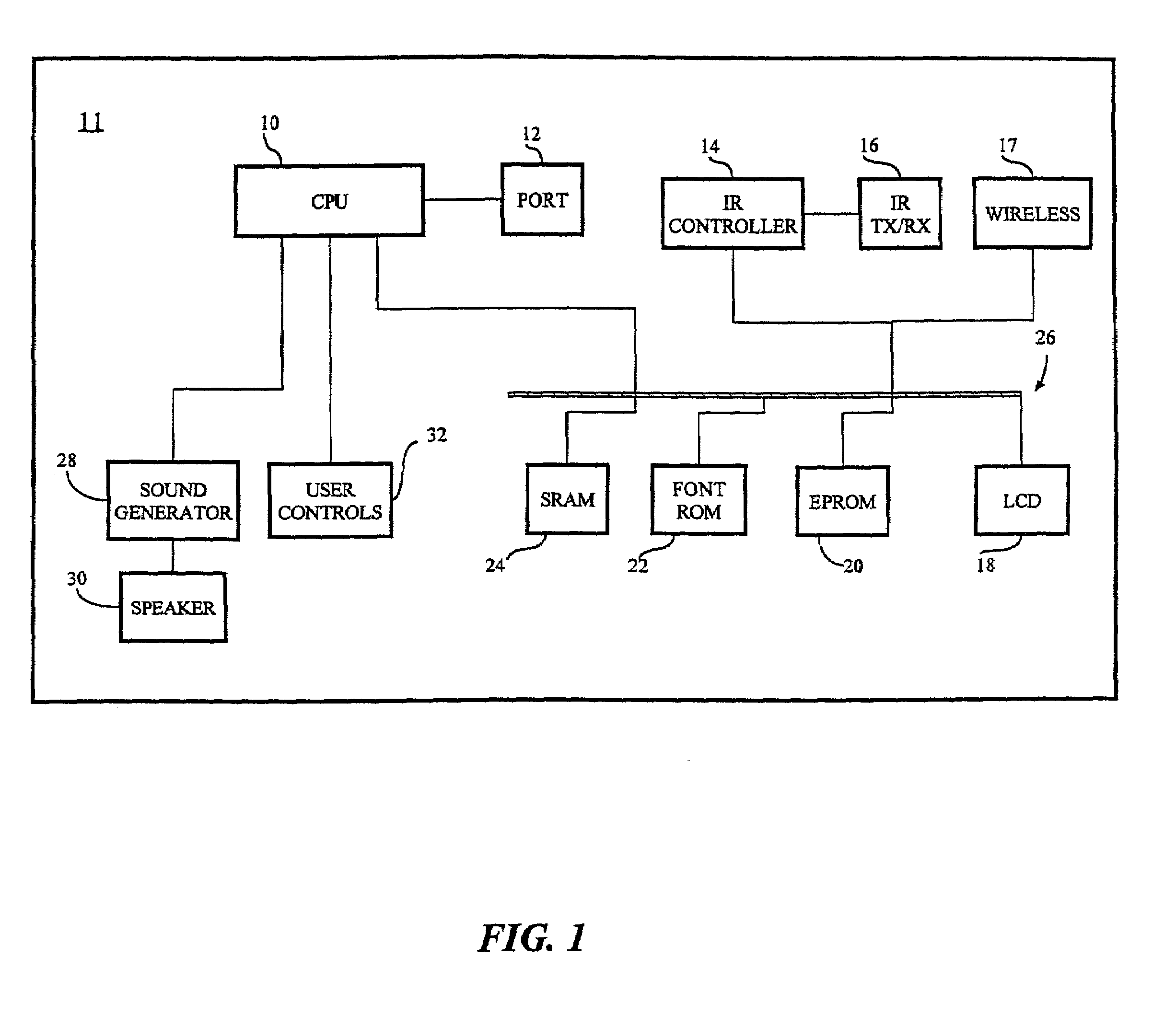

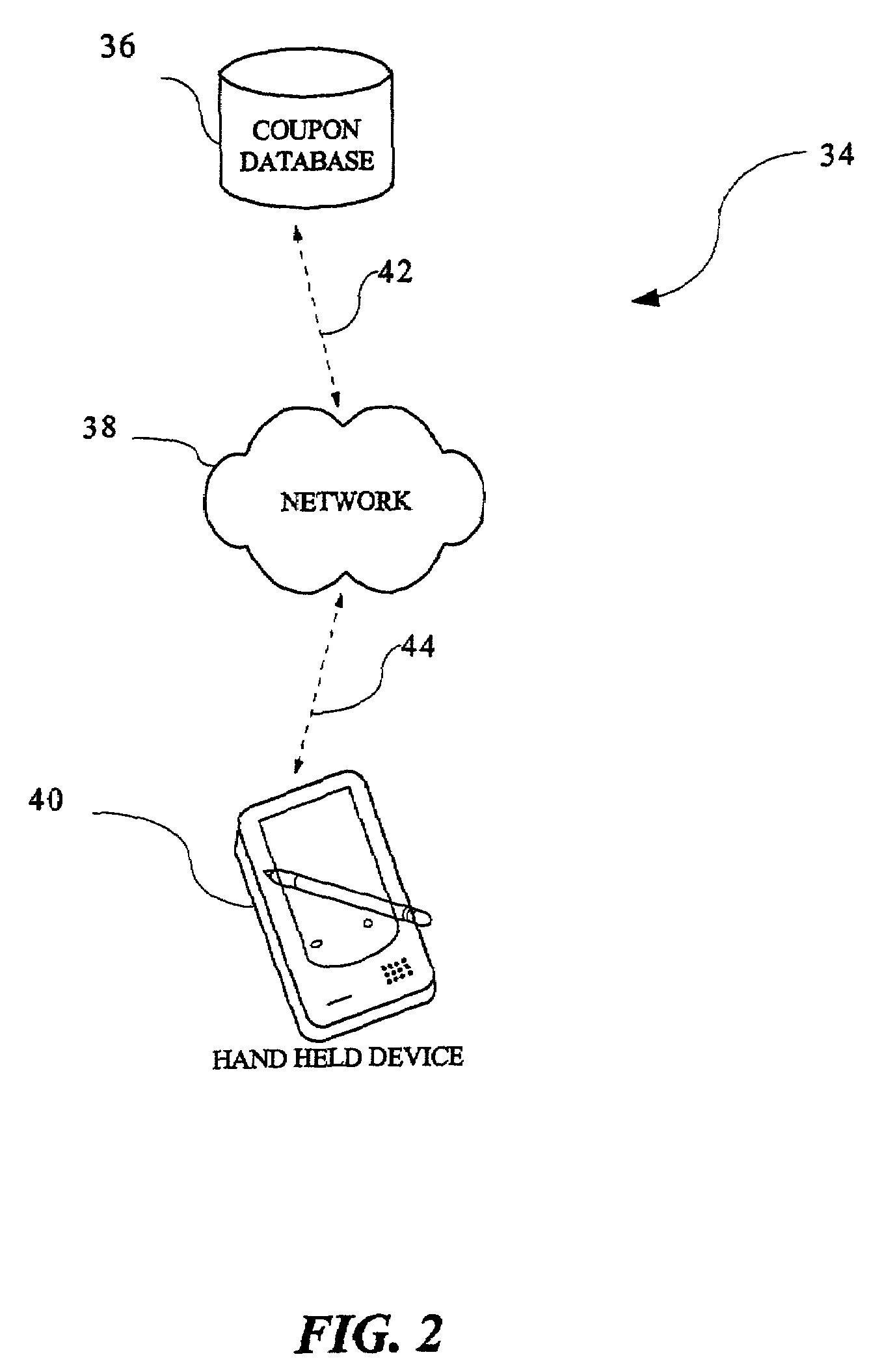

A method and system for processing negotiable economic credits (e.g., cash, credit card, enterprise incentives / award such as frequent flier miles, etc.) through a hand held device. Credits are storable in the form of credit data in a credit database associated with a point of sale and / or hand held device. Credit is retrievable from the credit database, in response to synchronizing a hand held device, such as a PDA, wireless PDA, paging device, cellular telephone, or other hand held computing device, with the point of sale. Credit data may be transferred to / from the hand held device, thereby permitting a user to maintain and manage enterprise credits based on the credit data, utilizing the hand held device. In one embodiment, when a particular number of enterprise credits have been earned, the user may utilize such credits to receive price discounts on enterprise products or services, or awards of such products or services. A user may also use credits earned for enterprise sponsored credit programs unrelated to transactions at unrelated enterprise having compatible points of sale for providing / receiving / processing credits, so long as credits are recognized at a point of sale.

Owner:RATEZE REMOTE MGMT LLC

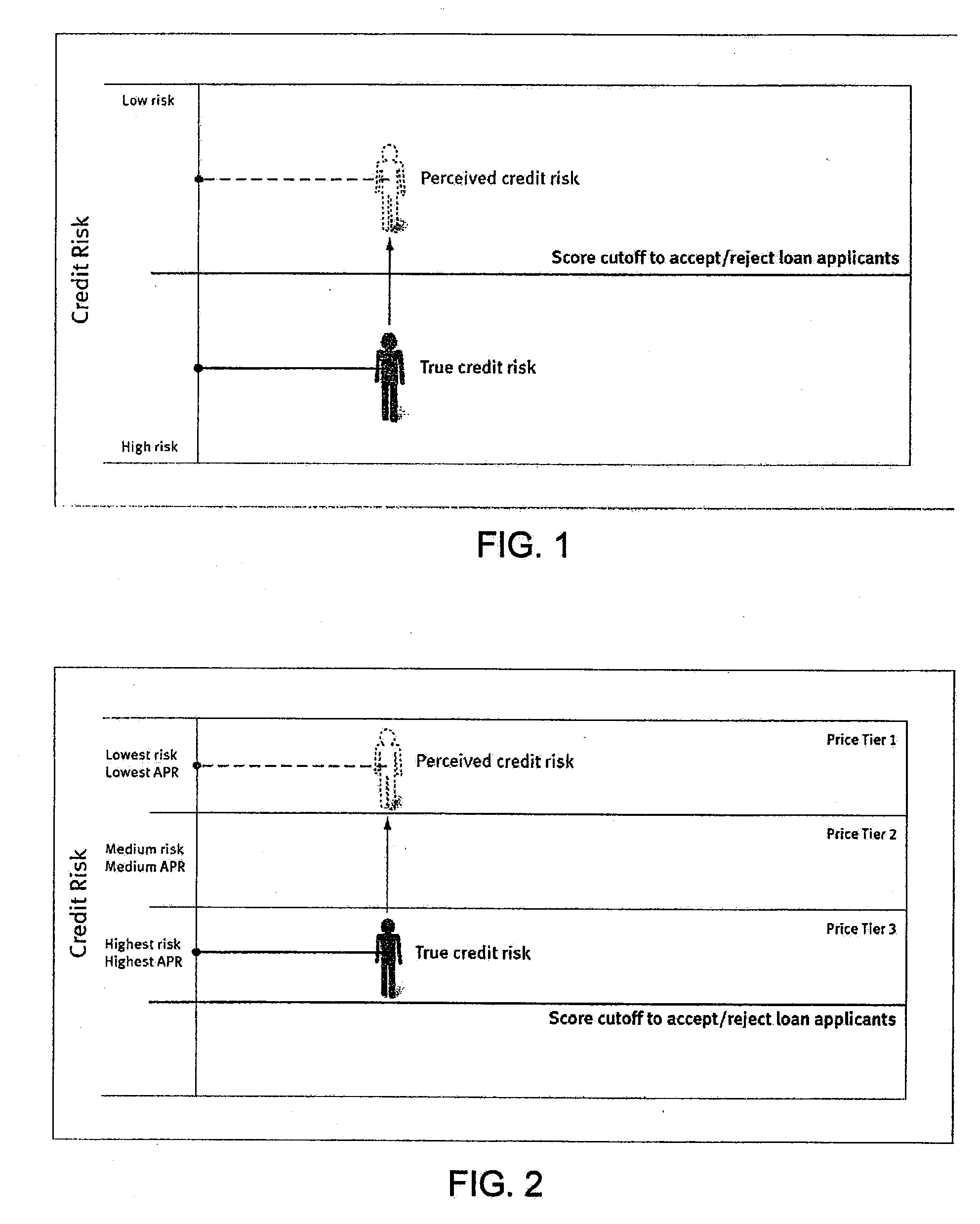

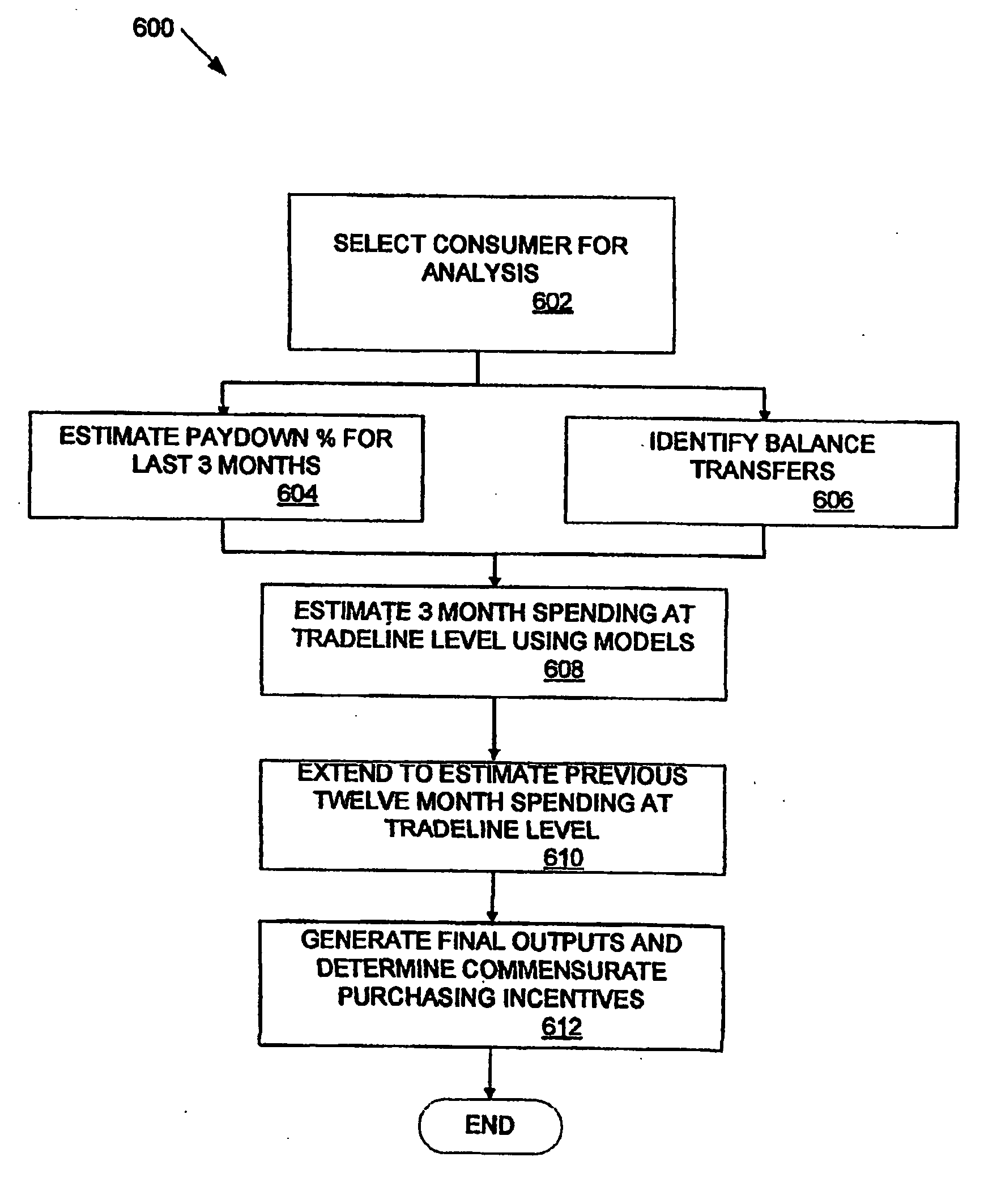

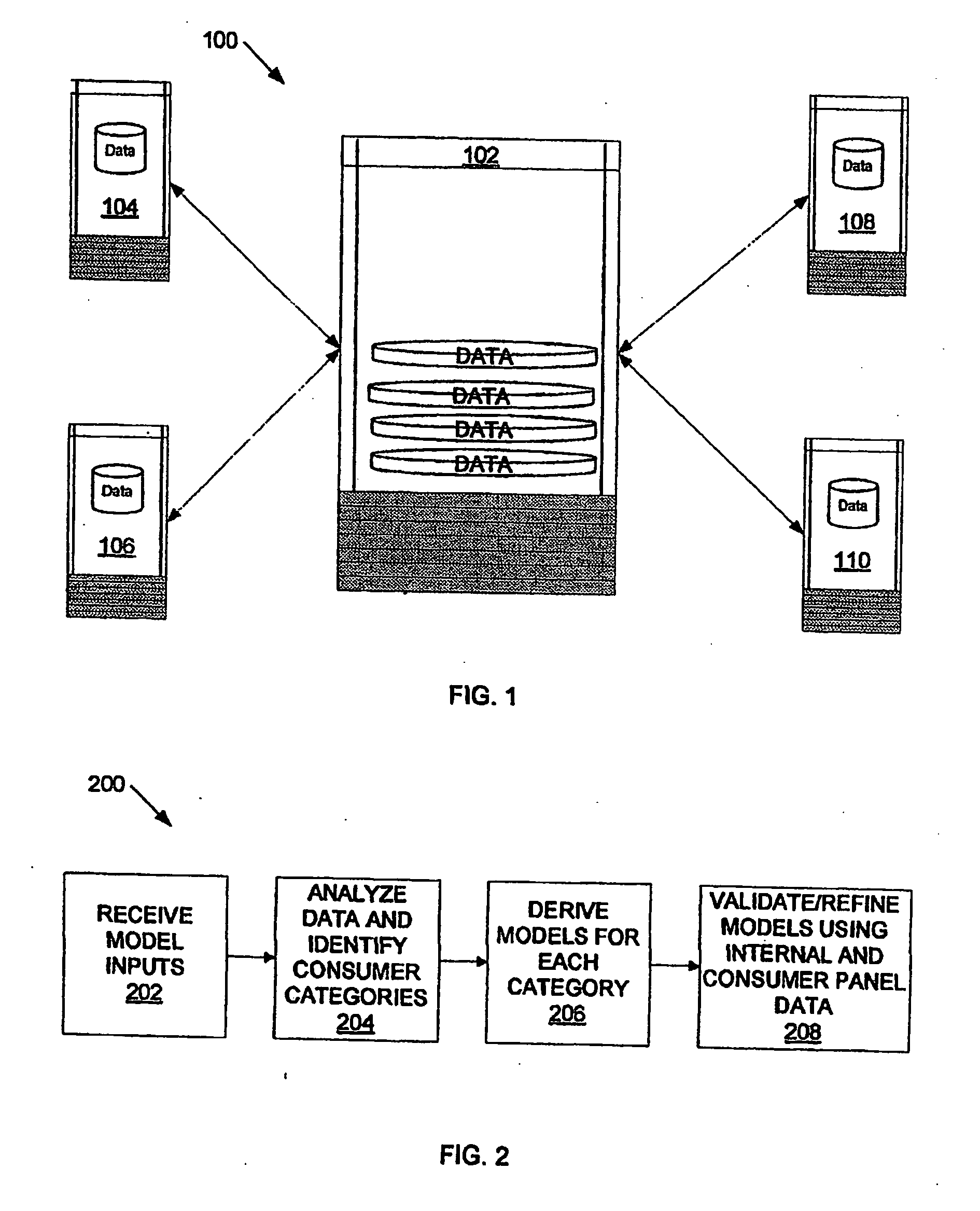

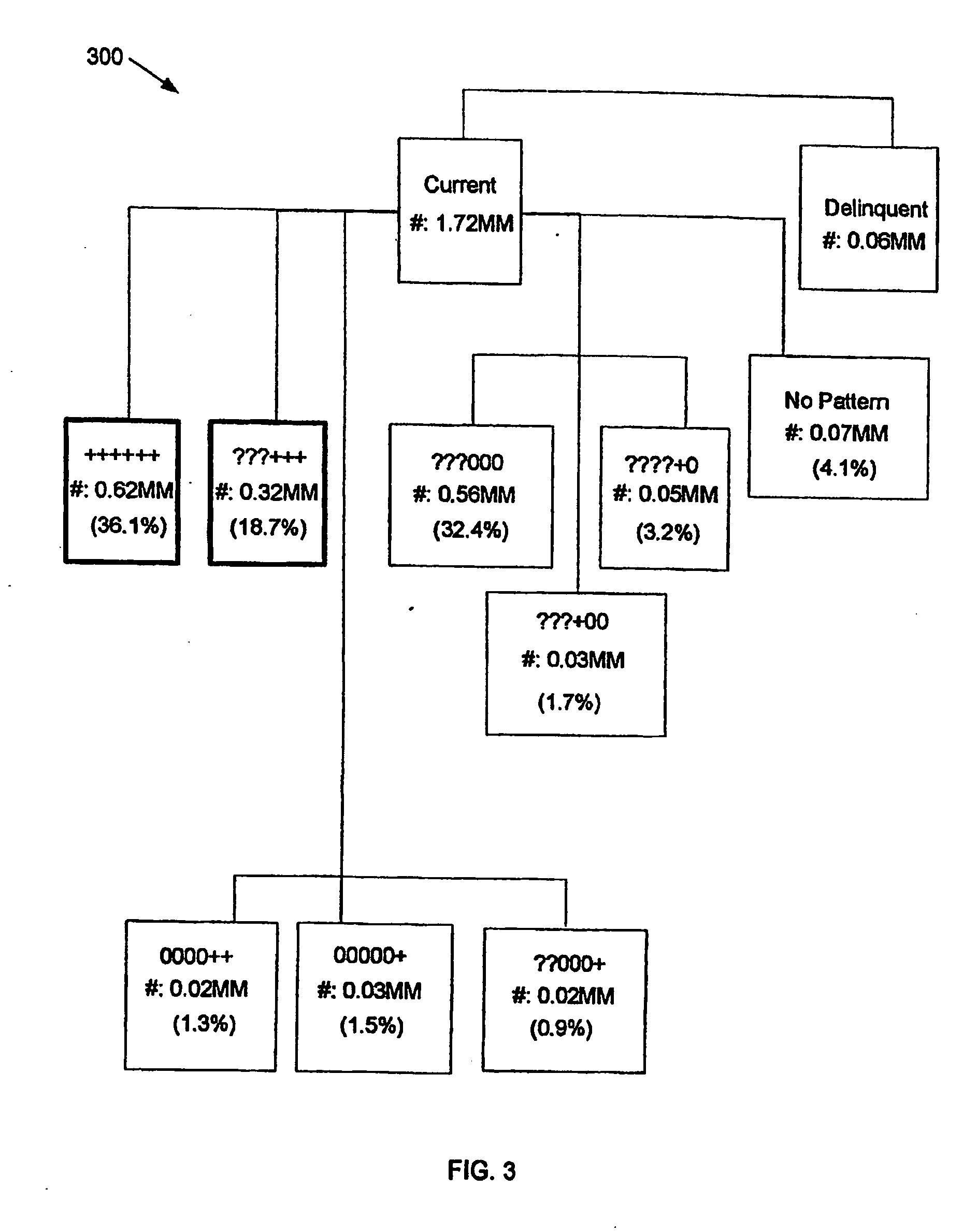

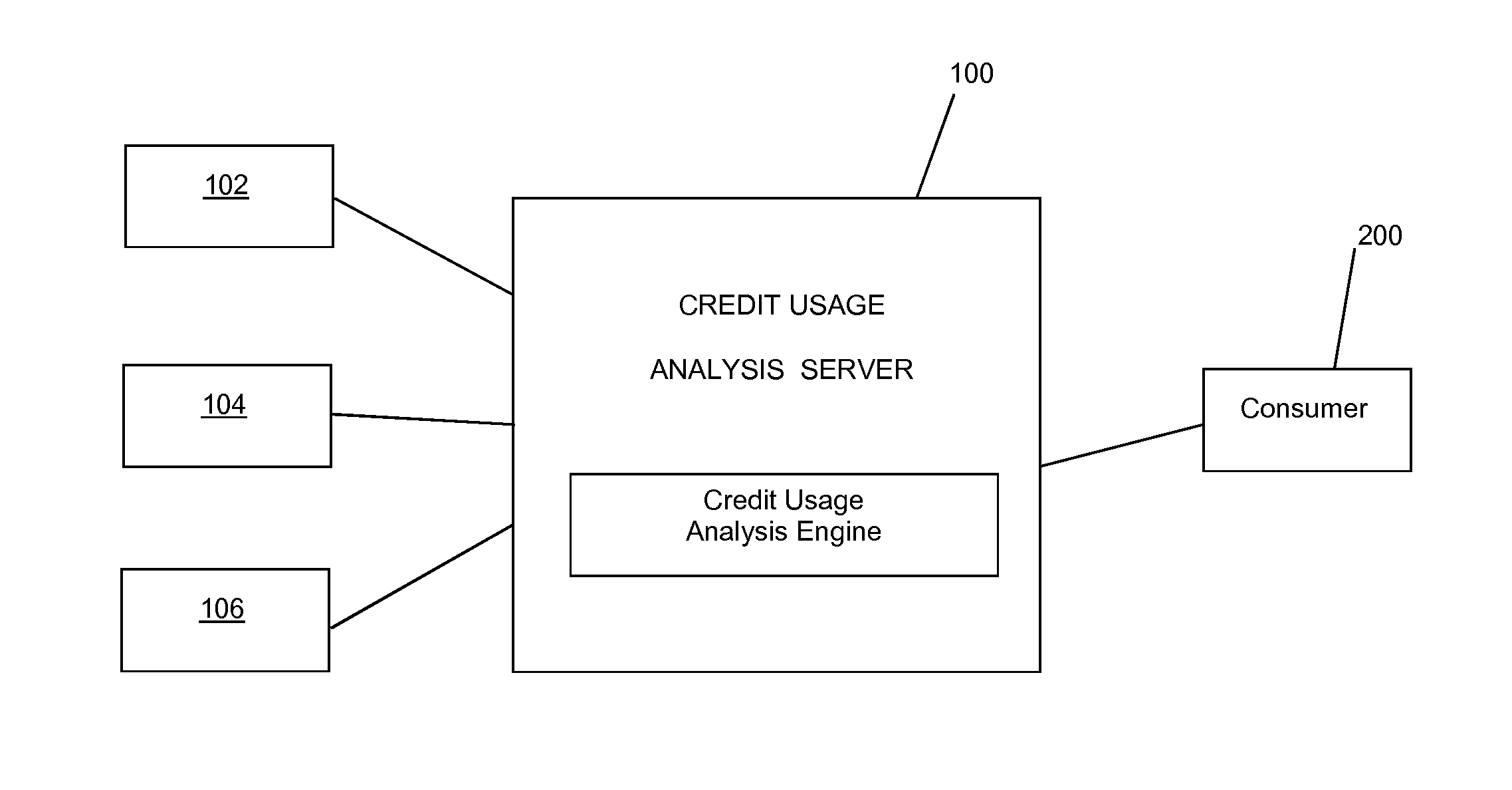

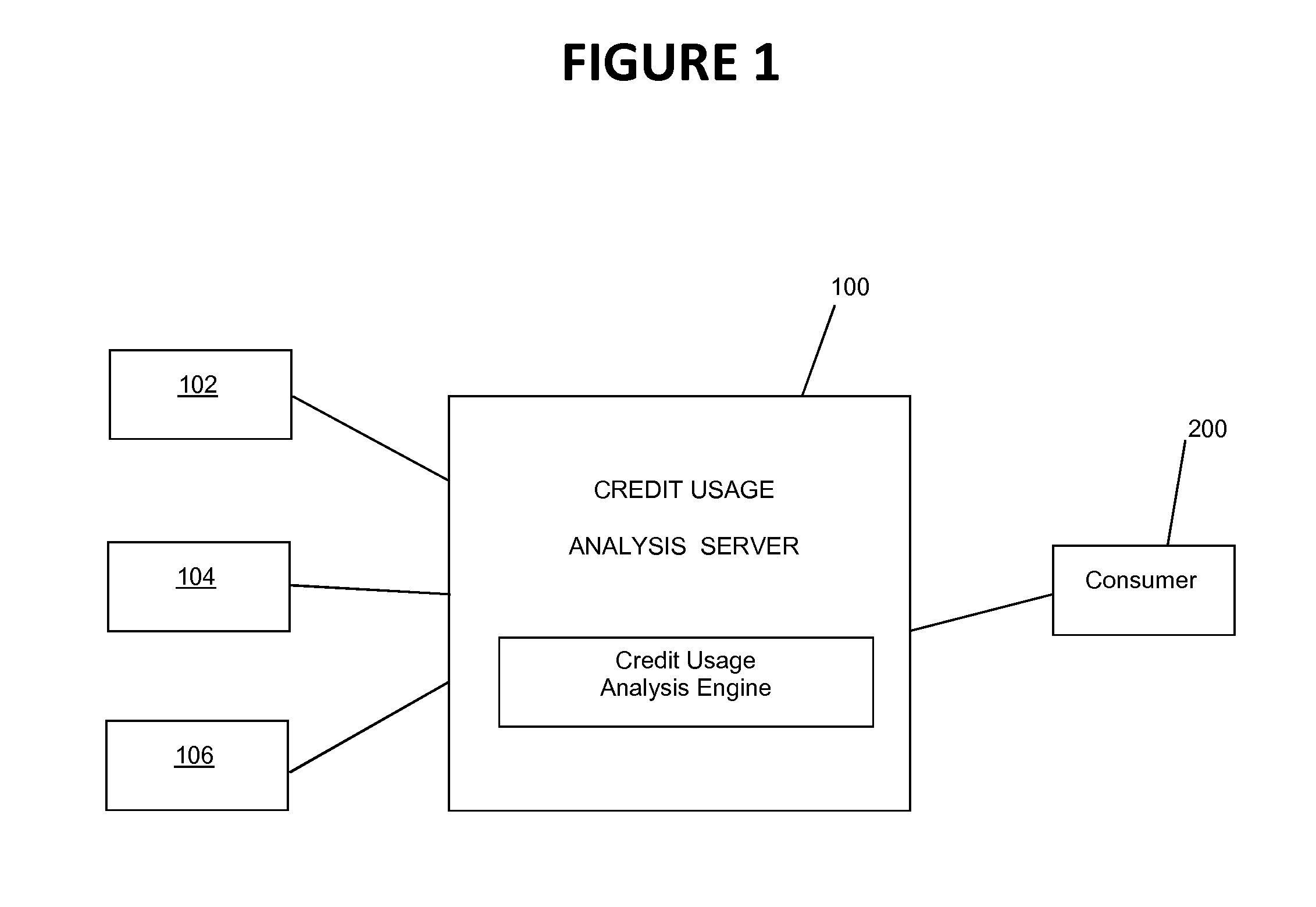

Method and apparatus for determining credit characteristics of a consumer

Share of Wallet (“SOW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumers spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. The outputs include the size of the consumer's spending wallet over a particular time period, the total number of the consumer's revolving cards, the consumer's revolving balance, the consumer's average pay-down percentage for revolving cards, total number of the consumer's transacting cards, the consumer's transacting balance, a number of balance transfers transacted by the consumer, the total amount of the consumer's balance transfers, the consumer's maximum revolving balance, the consumer's maximum transacting balance, the consumer's credit limit, size of the consumer's revolving spending, and the size of the consumer's transacting spending.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

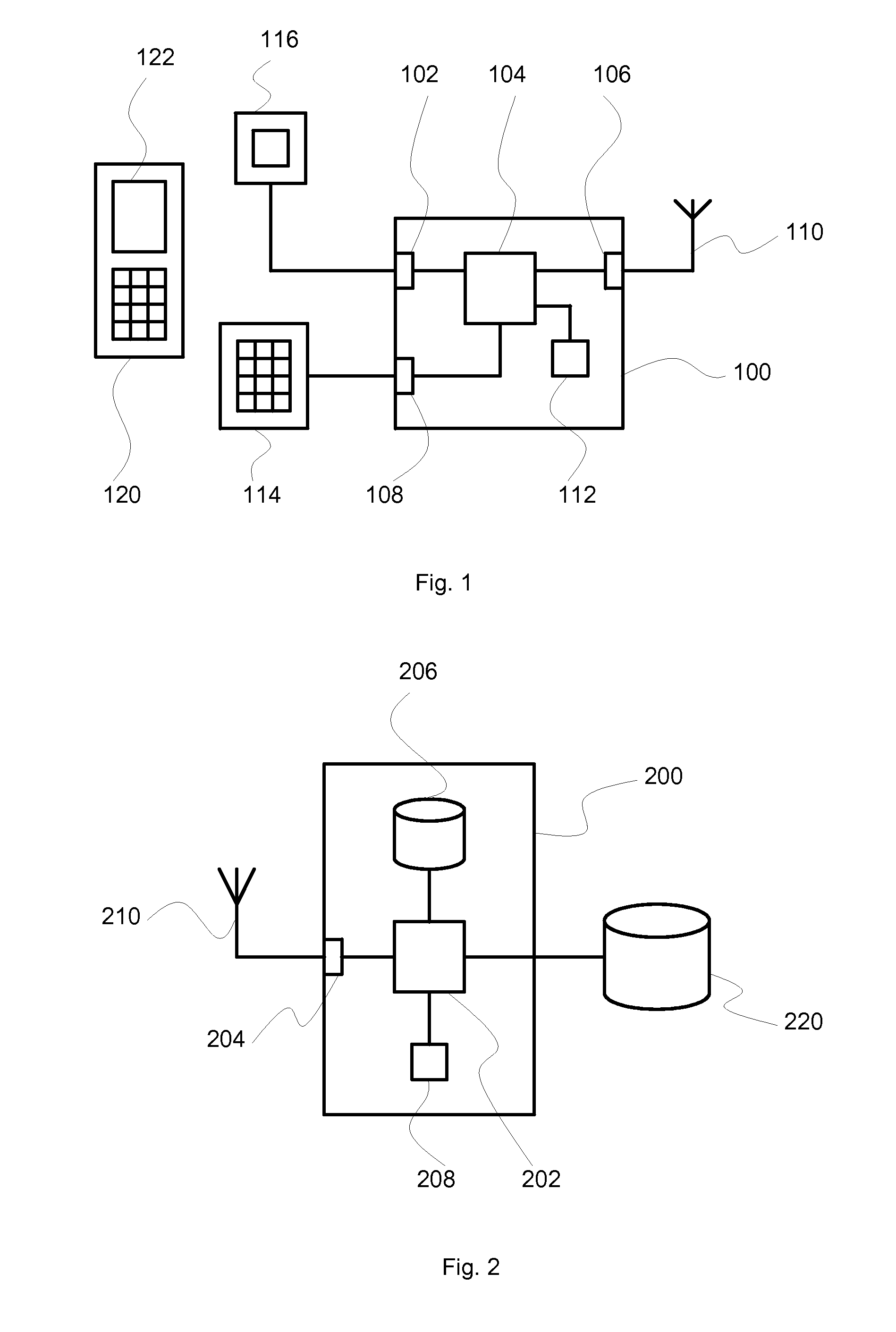

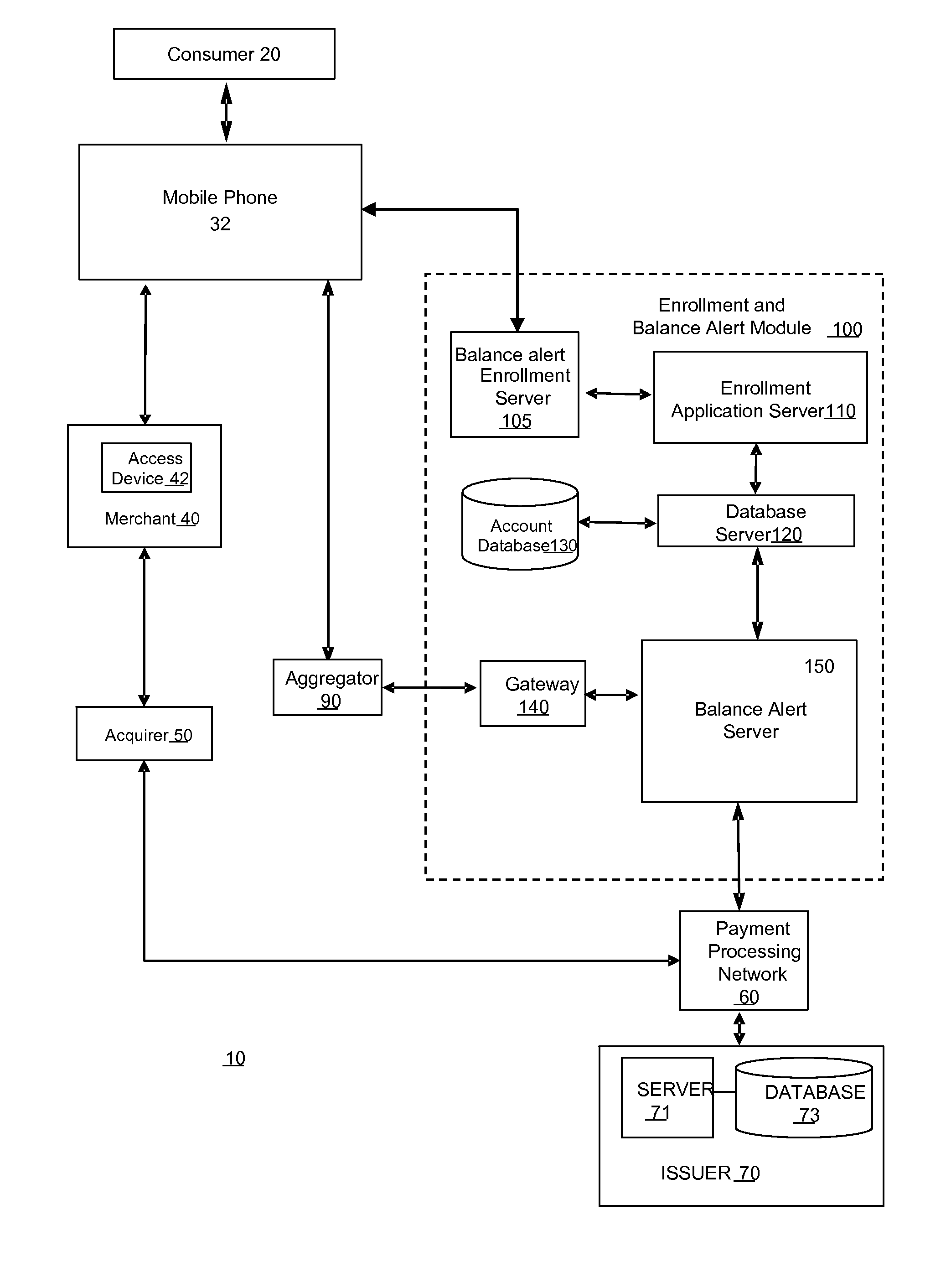

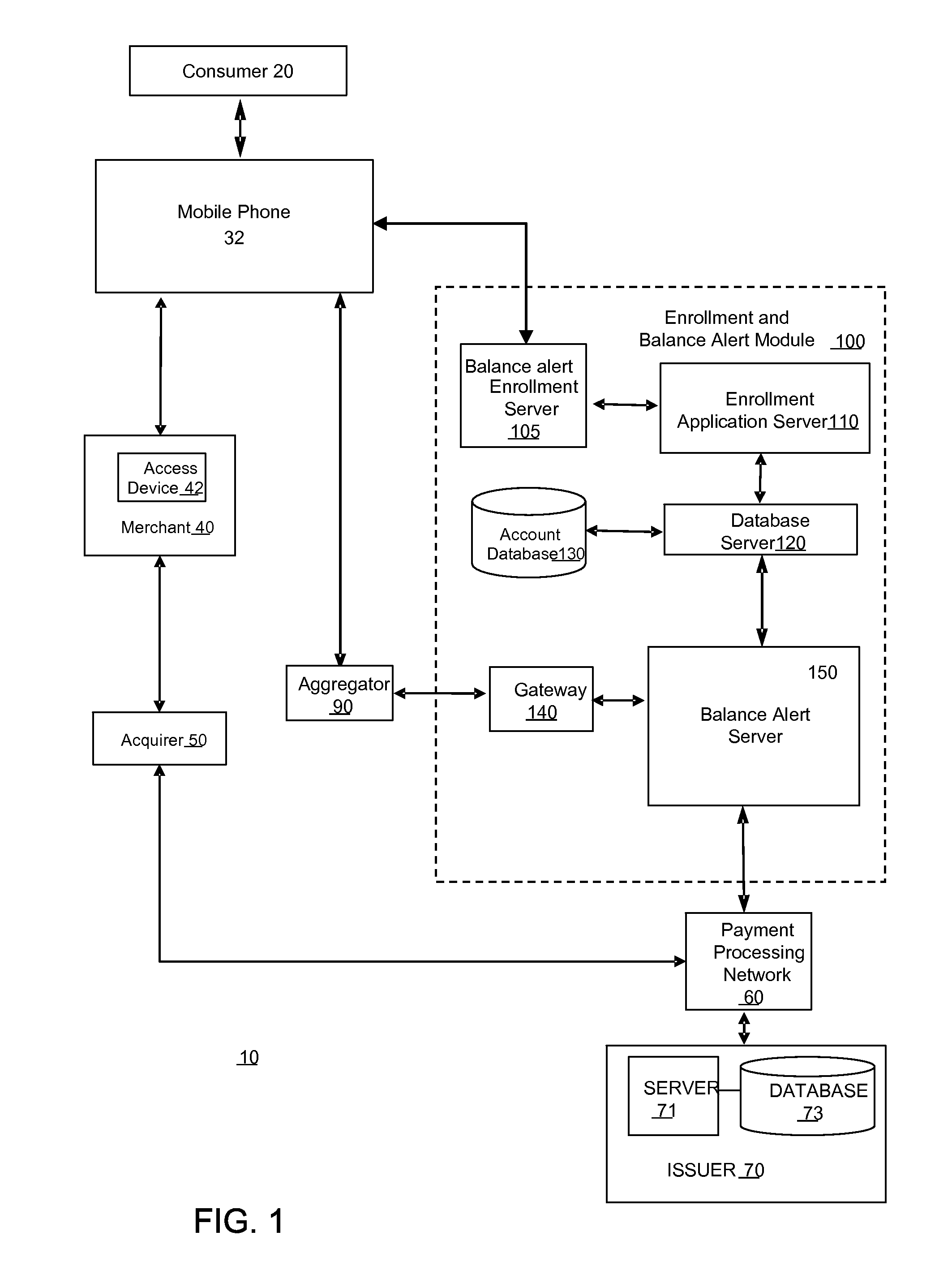

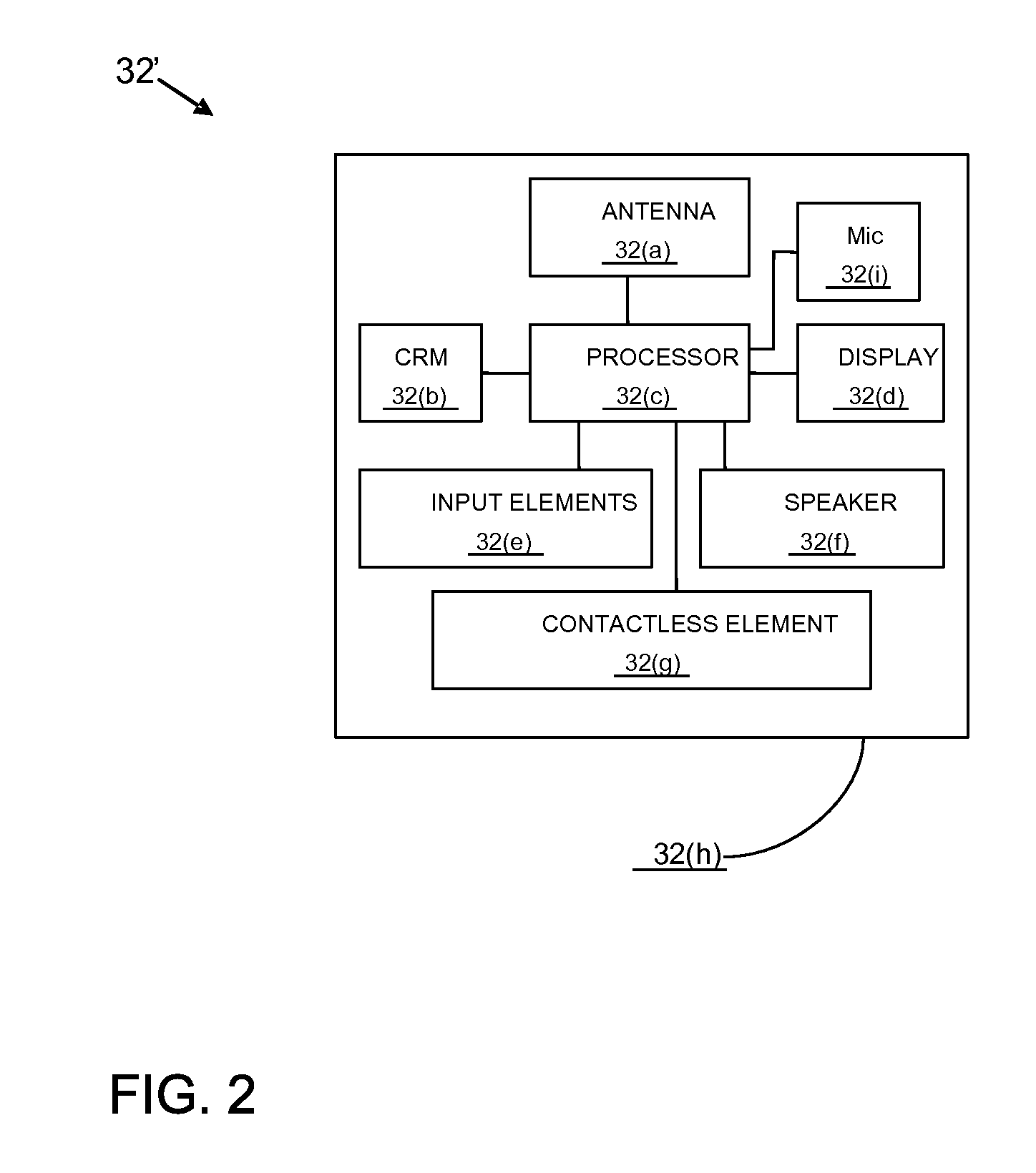

Mobile phone payment process including threshold indicator

System, methods, and apparatus provide account balance alerts for a mobile phone used to initiate a transaction when an account balance is close to a credit limit or close to zero or a minimum balance amount. When a consumer uses an account associated with a mobile phone to make a purchase, the account is checked to see if the purchase would result in an account balance within a predetermined threshold of the credit limit in the case of a credit account, or within a predetermined threshold of zero or a minimum balance, in the case of a debit account. If the threshold has been surpassed an account balance alert is automatically sent to the mobile phone. Since the mobile phone was just used for the transaction, the consumer is timely notified of the approach of the balance to the credit / debit limit and can take corrective action in a timely manner.

Owner:VISA USA INC (US)

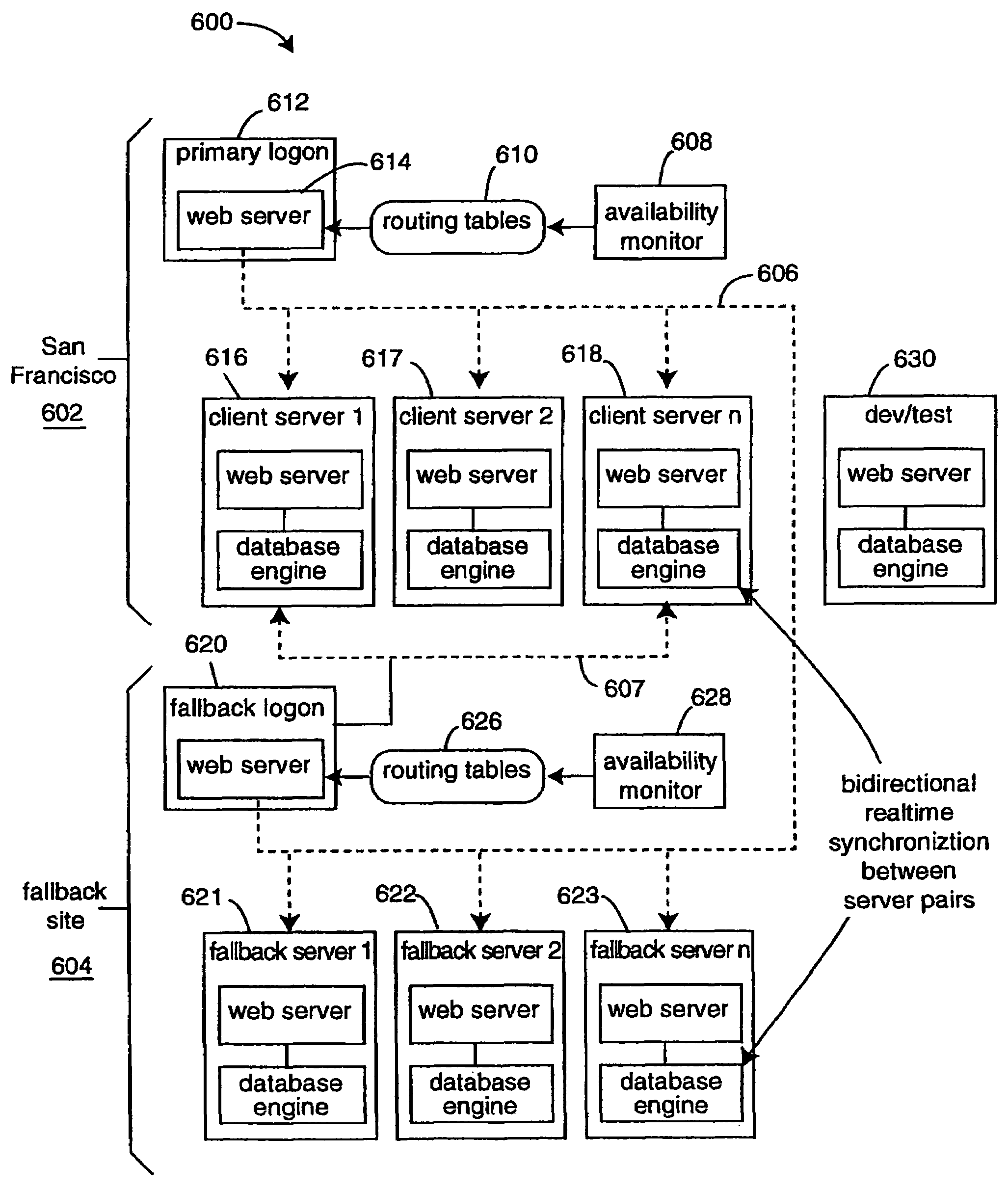

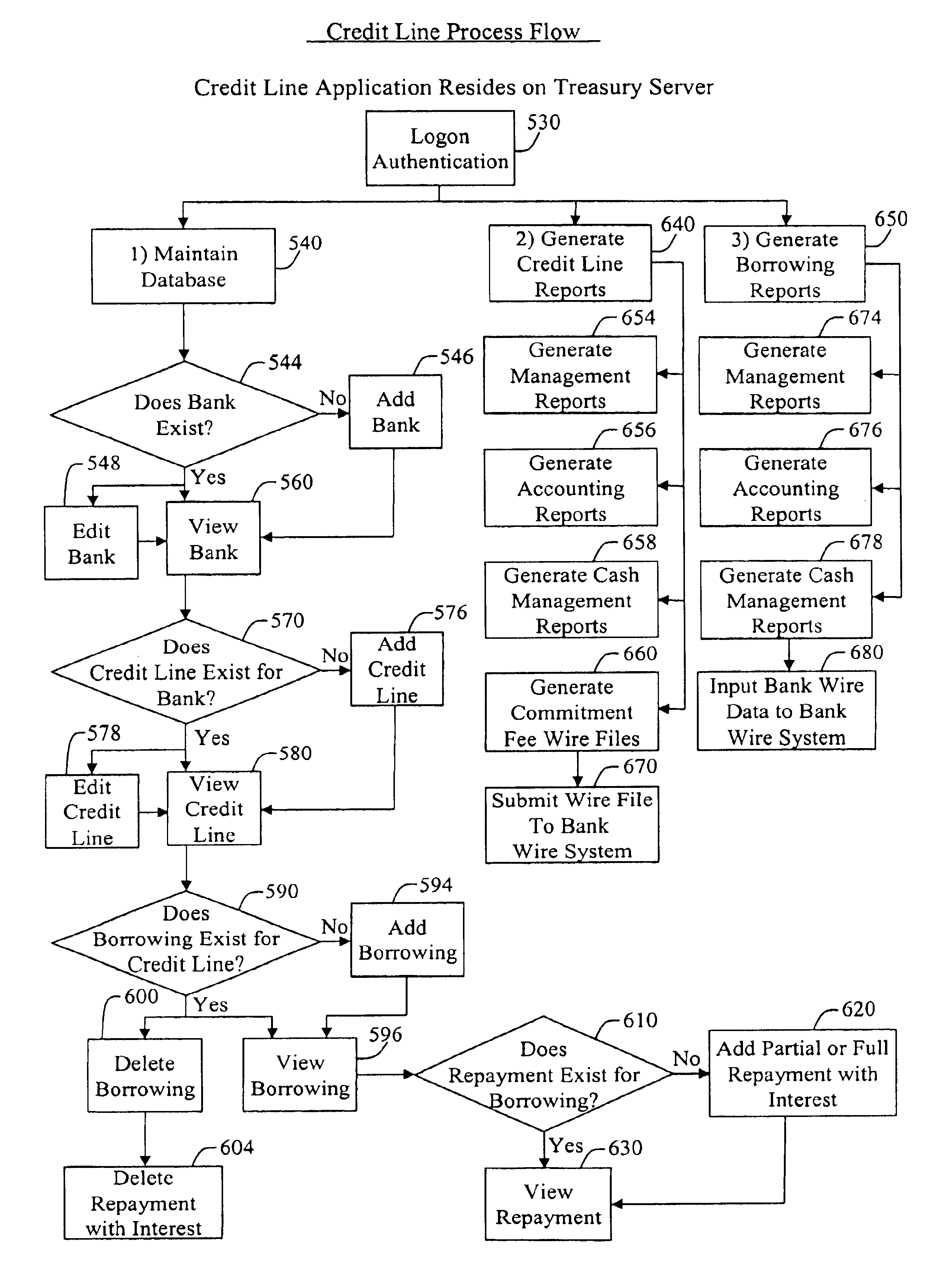

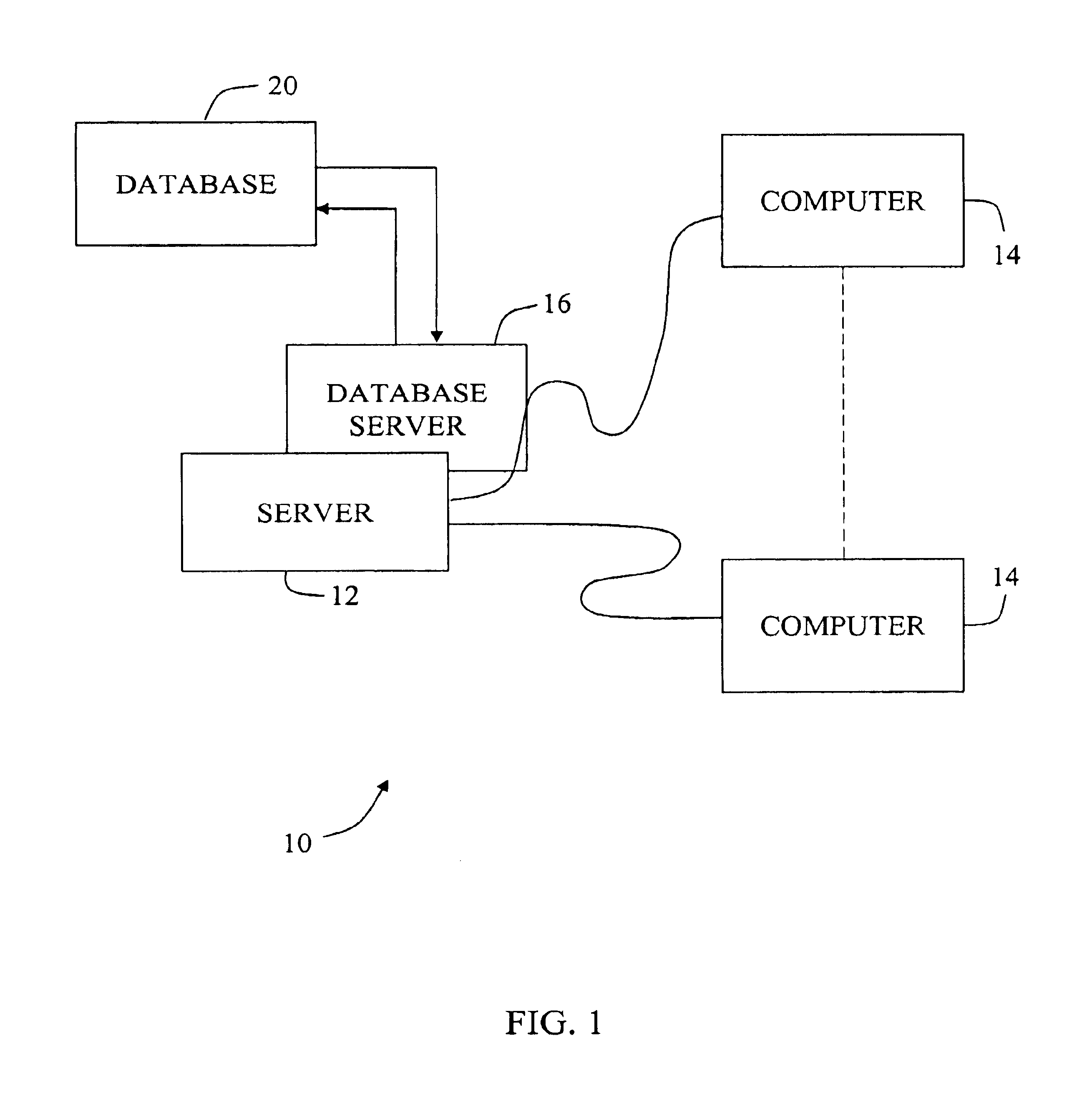

Systems and methods for credit line monitoring

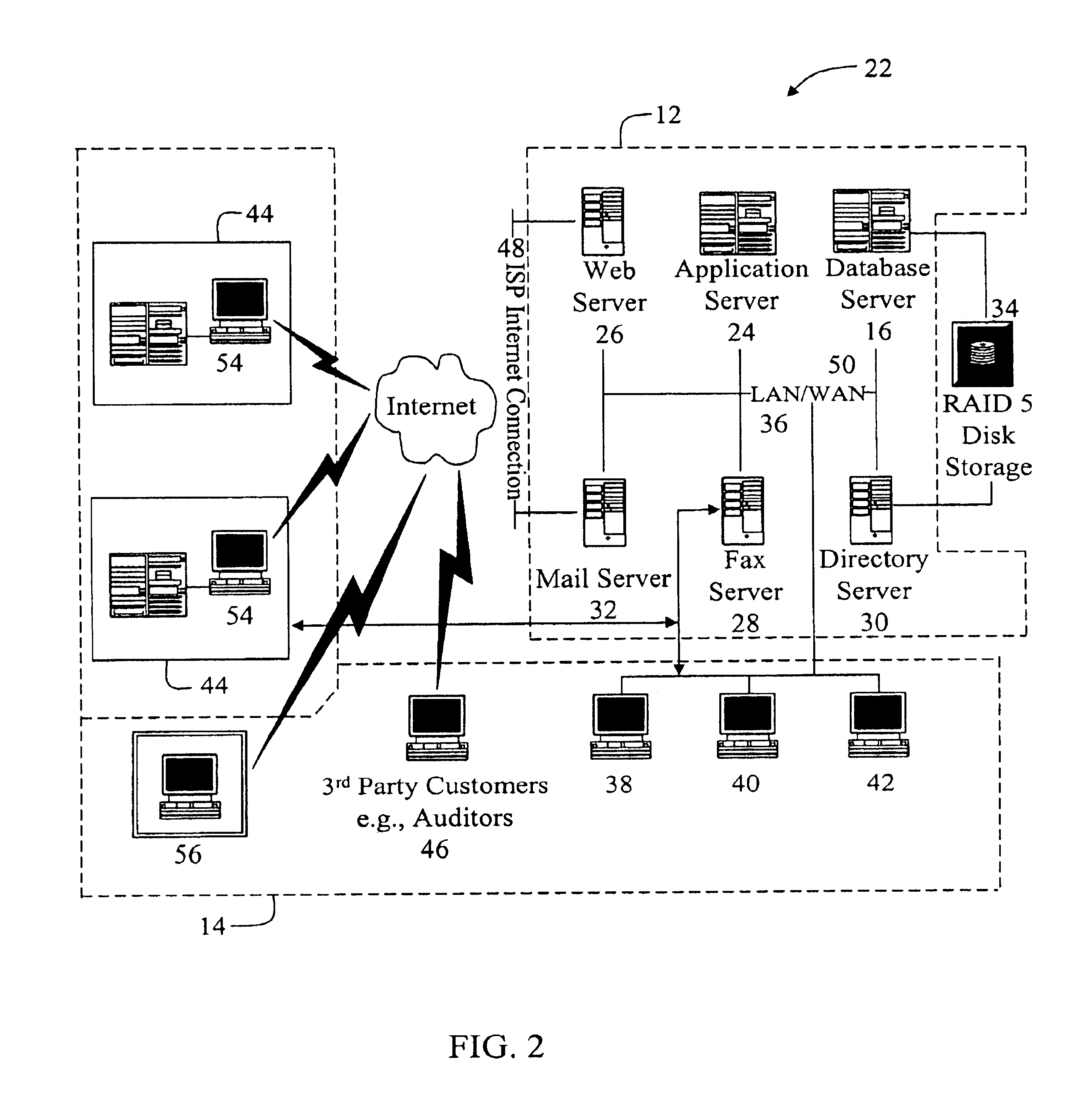

InactiveUS6873972B1Facilitates efficient credit line monitoringFinanceCredit schemesCentralized databaseCentral database

In one embodiment, the present invention is a method and a system for tracking bank credit lines and borrowing. The method involves tracking credit ratings of a bank, requesting the bank to establish a line of credit, accessing a centralized database to obtain and maintain information regarding the line of credit, automatically transmitting domestic and international wire information for cash movement to the bank, and finally posting borrowing journal entries to a general ledger for financial monitoring, reporting and auditing purposes. The method and the system are capable of handling multi-currency transactions involving domestic and international banks.

Owner:GENERAL ELECTRIC CO

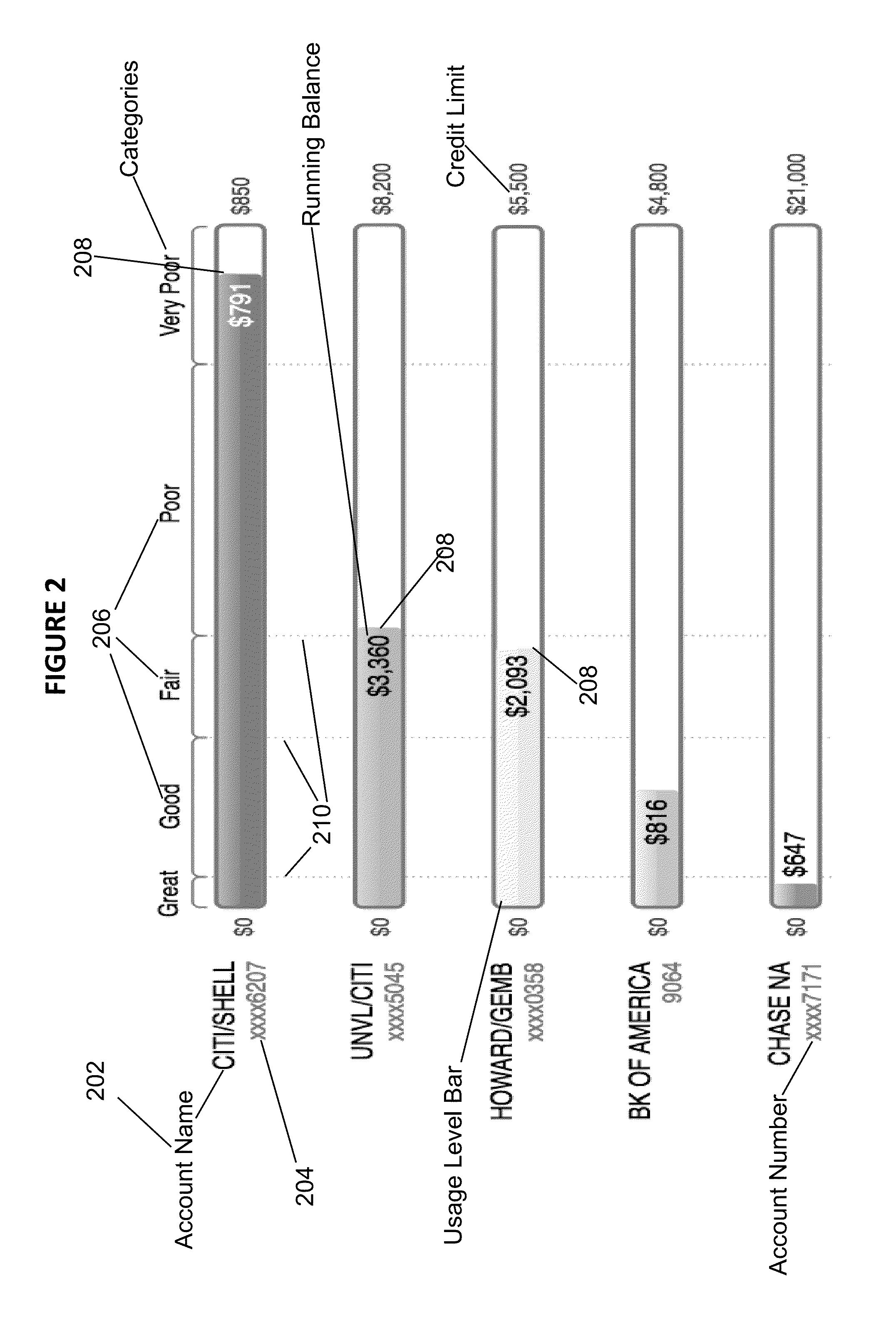

System and method for determination and reporting of credit use and impact on credit score

Disclosed is a system and method for the automated generation and display of an electronic, graphical representation of the effect of a consumer's credit card usage as a percentage of credit limit on such consumer's credit score. The presentation may show each credit card account with a graphical view of the level of usage on each of a user's card accounts and further shows in which category that usage level falls. The levels of credit usage are classified for each card account into qualitative categories. Each category is designed to communicate to the consumer the statistical association between the usage level on that account and credit scores.

Owner:CREDITXPERT

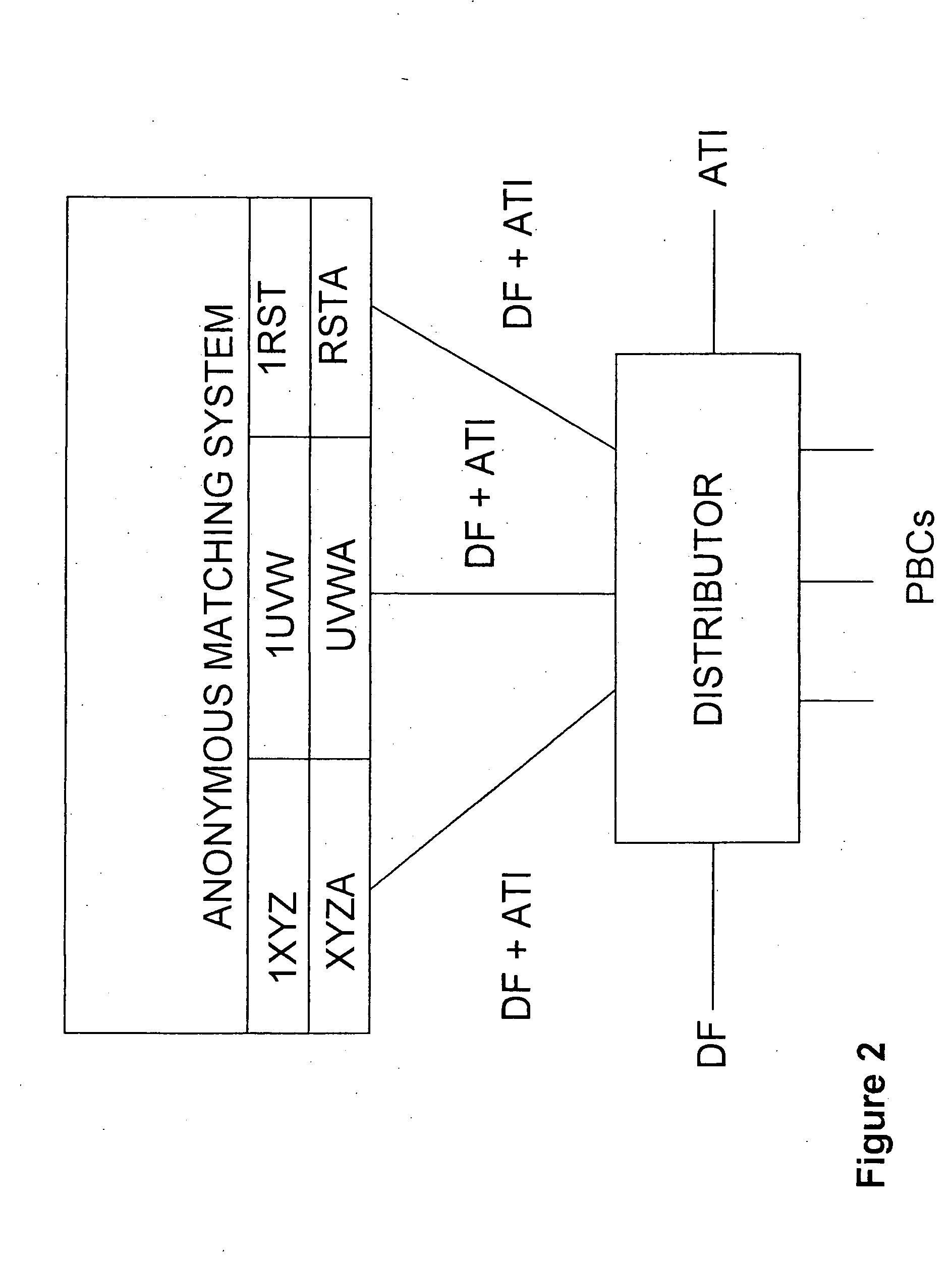

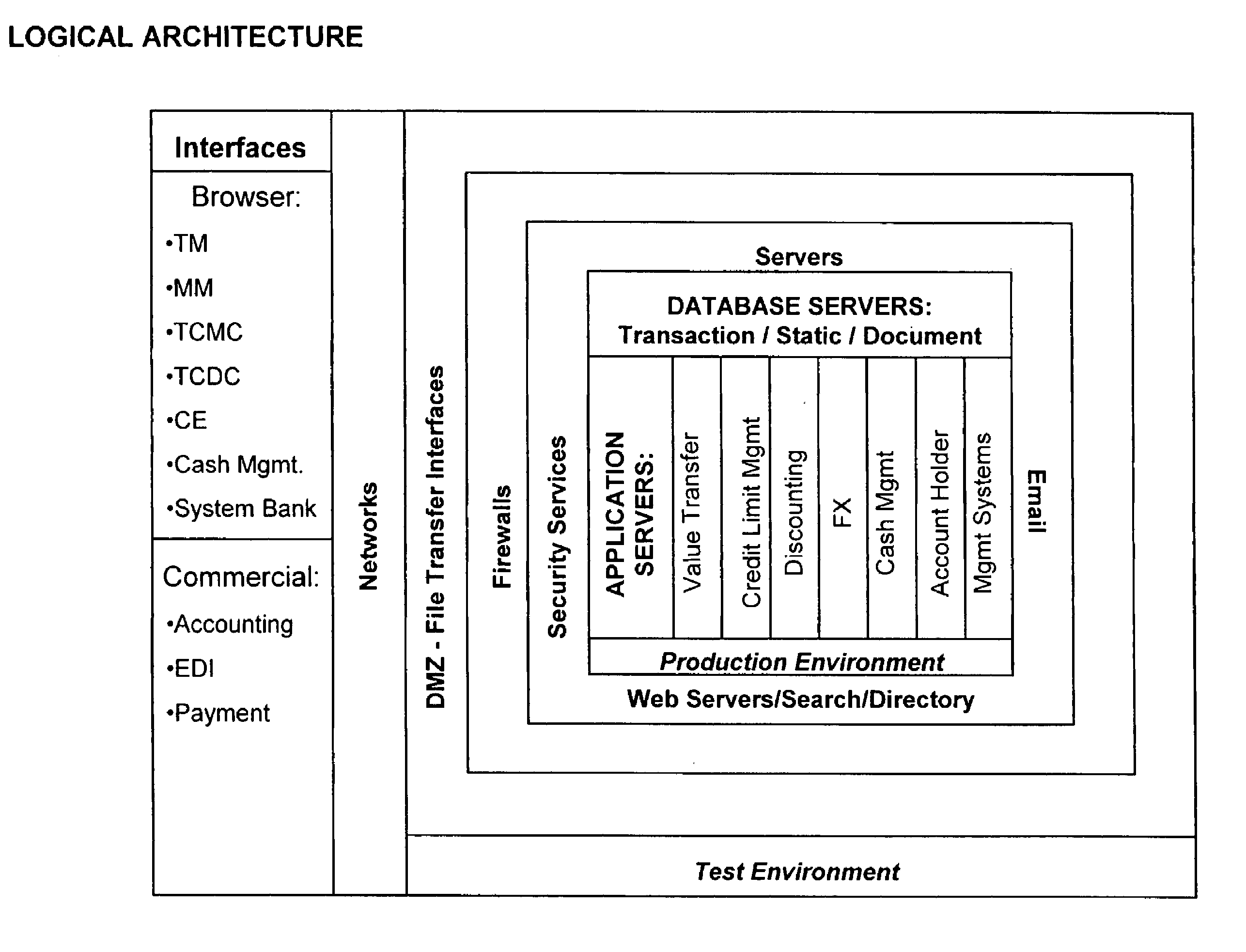

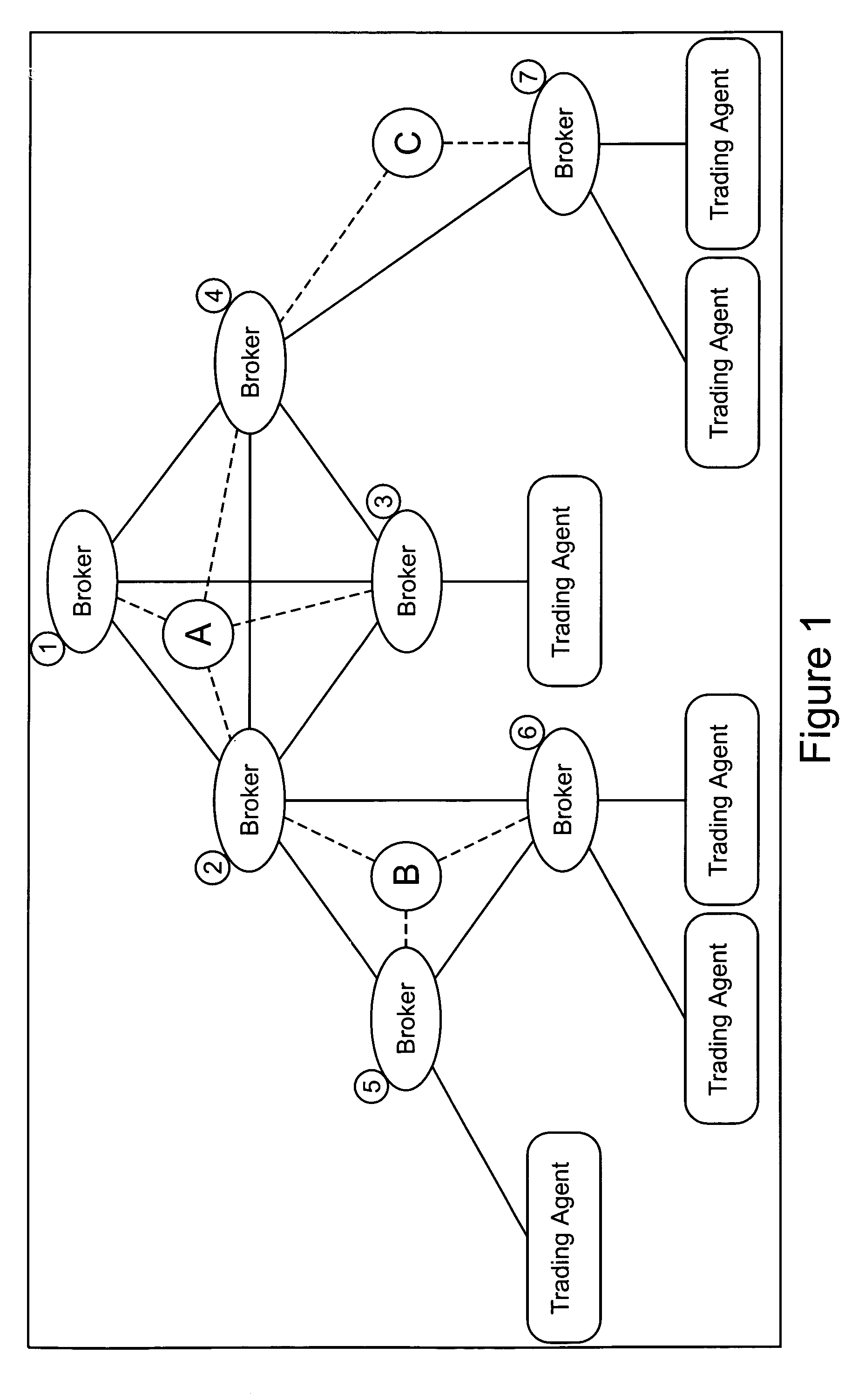

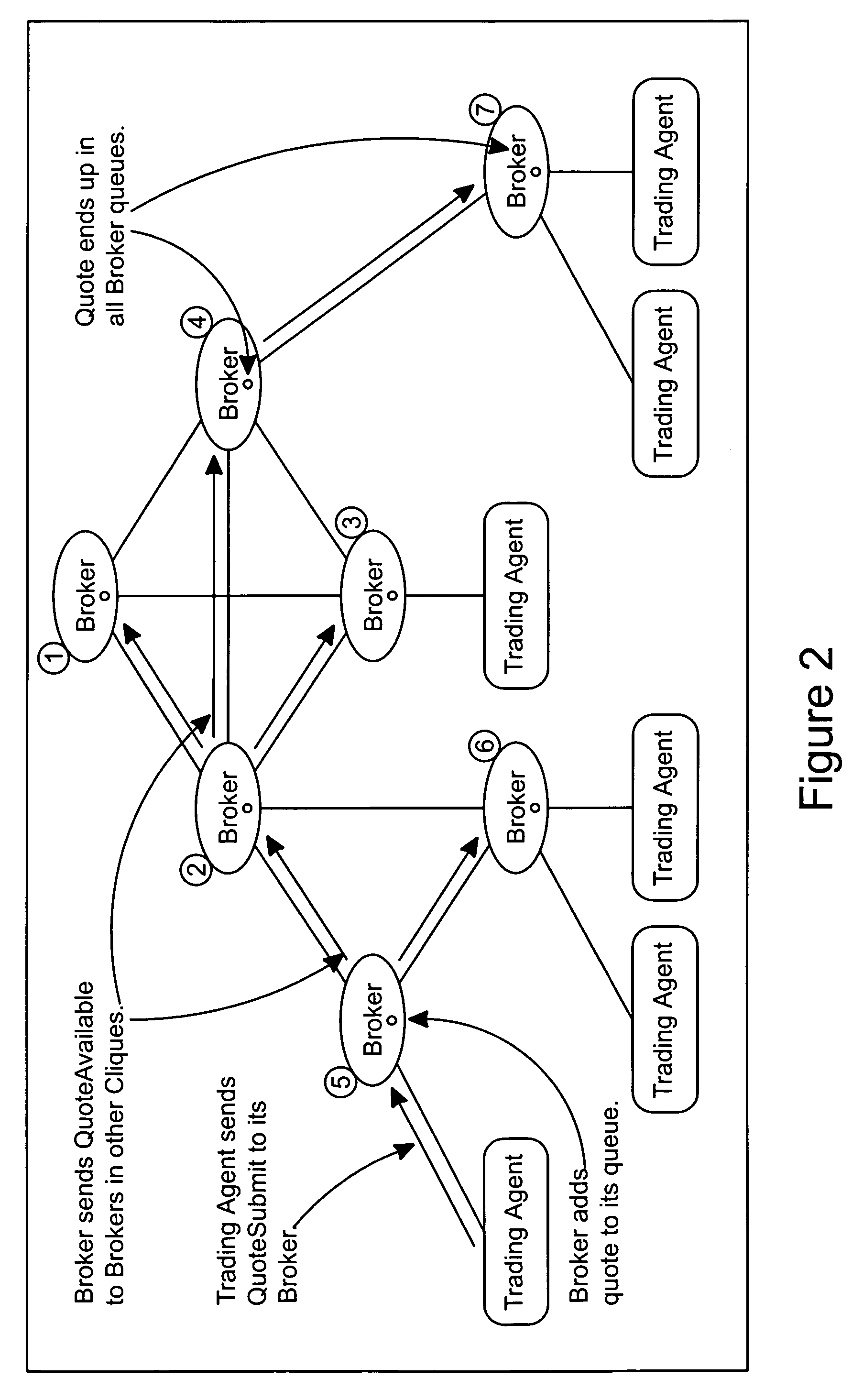

Automated trading system

An anonymous trading system is configured to receive a price stream from a bank or other institution. The price stream is converted into a quote stream and input into the trading system via an automated trading interface. The quote stream has its own deal code. The deal code credit limits are set so that the only parties that have credit with the deal code are other deal codes of the same institution. At least one of these deal codes represents a prime broker bank and prime broker customers therefore have access to the institution's price stream to the exclusion of other parties trading on the system. A distributor distributes the quotes from the trading system to the prime broker customers' traders, to prime broker customer automated trading interfaces, and to prime broker customer deal feed systems for logging of deal tickets and communication of those deal tickets to back office systems.

Owner:NEX GRP PLC

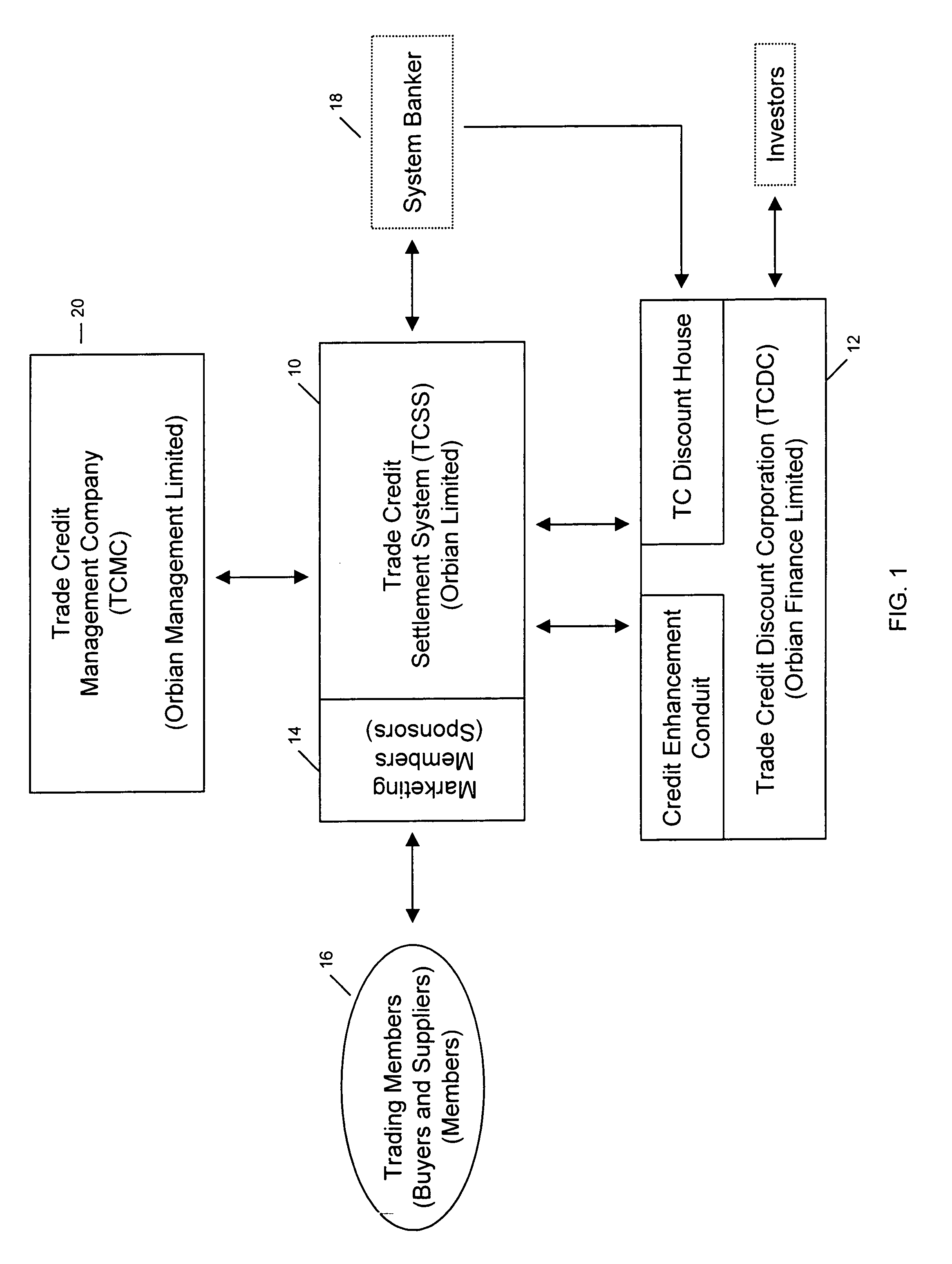

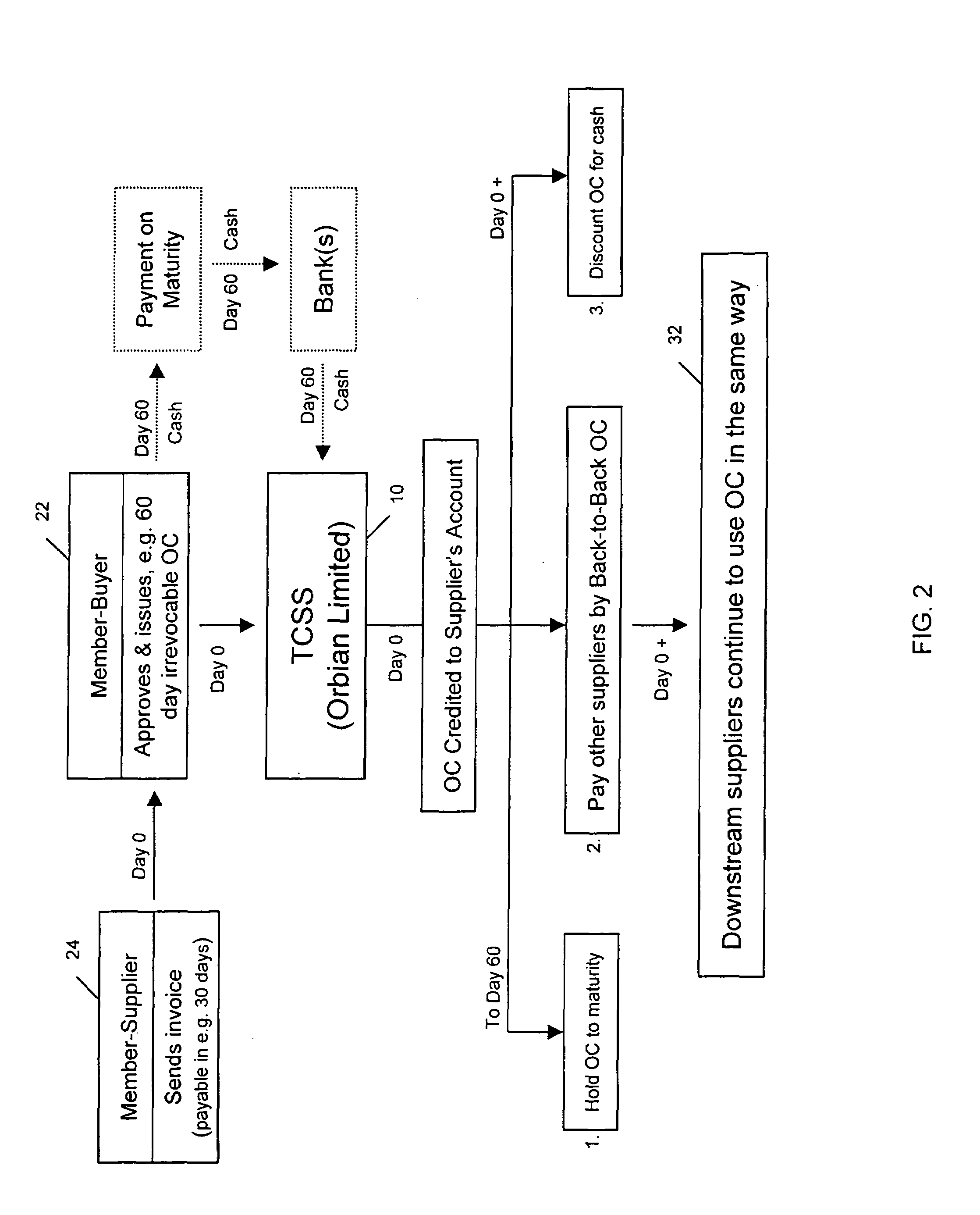

System and method of transaction settlement using trade credit

A method and system for settling a transaction with trade credit value which makes use of computer hardware and software, allows Members of a trade credit settlement system to transfer electronic instruments, called trade credits, in exchange for goods and services. These trade credits are effectively electronic bills of exchange that are divisible, transferable, discountable, continuously available and have been credit-enhanced to A1 / P1 status. Sponsors facilitate the system by registering buyers and suppliers as Members in the system and offering them operational accounts and drawdown accounts with authorized lines of credit. A Member-buyer approves the purchase invoice of a Member-supplier and authorizes the Sponsor to transfer trade credit value from the Member-buyer's operational and / or drawdown account into the operational account of the Member-supplier. The trade credit value received by the Member-supplier can be held in the Member-supplier's operational account until it matures, or discount it to cash before it matures, or transfer it to other Members for the purchase of goods or services.

Owner:ORBIAN MANAGEMENT

Wins of restricted credits in a gaming machine

InactiveUS20060247028A1Without increasing financial liabilityEncouraging further playDiscounts/incentivesApparatus for meter-controlled dispensingCredit limitOperations research

Disclosed is a gaming system and method designed or configured to provide wins of restricted credits. Restricted credits may be awarded according to the same or a different pay table than cashable credits on the same machine or at the same gaming property. Where separate pay tables are used for restricted and cashable credits, the invention may be implemented with a machine that accepts and pays only restricted credit according to a single, fixed internal payout schedule (“pay table”). Alternatively, the invention may be implemented with a machine that pays restricted credit according to one fixed internal pay table and cashable credit according to another fixed internal pay table. Or, a machine may pay restricted credit according to an external pay table provided by a host system to which the machine is connected.

Owner:IGT

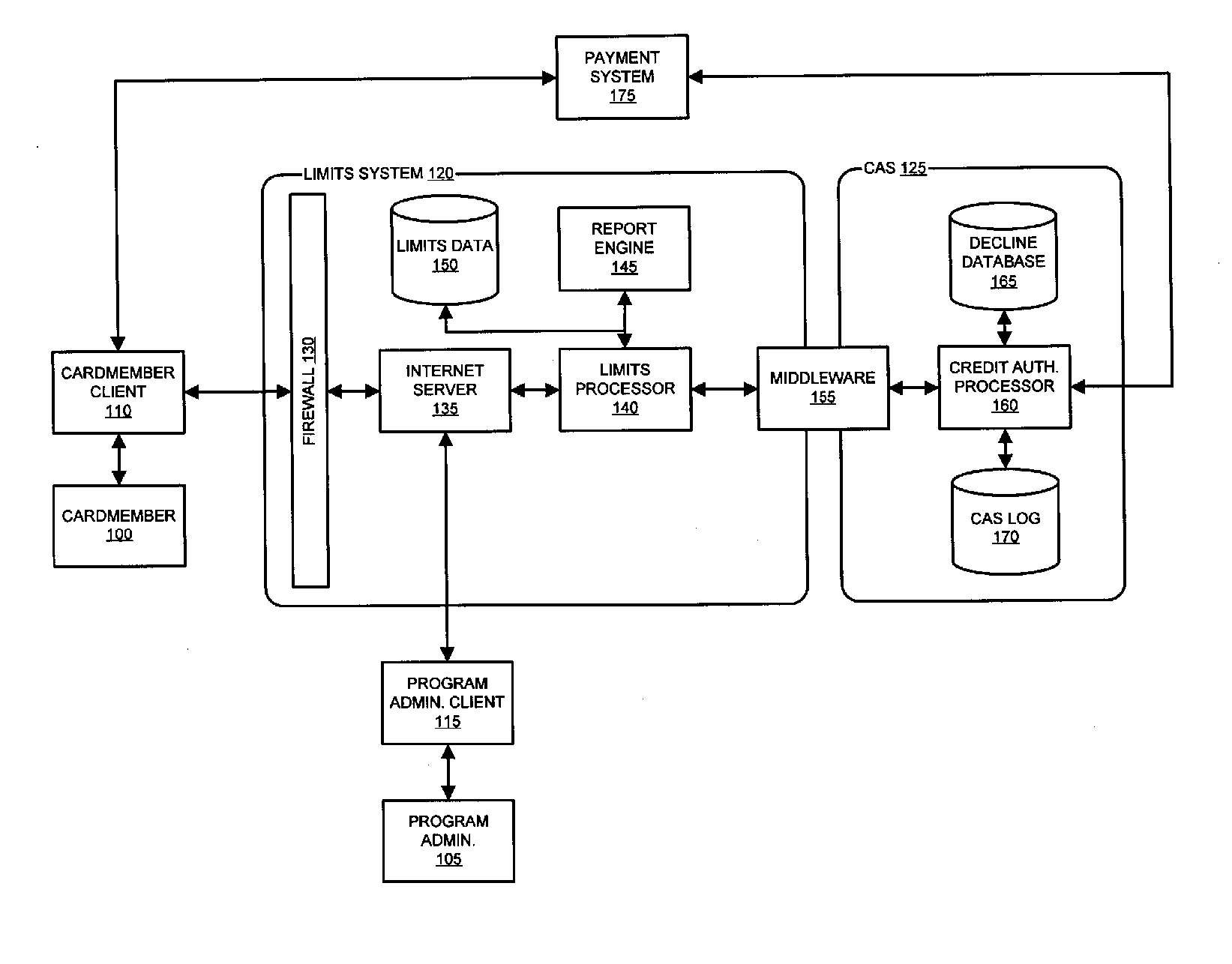

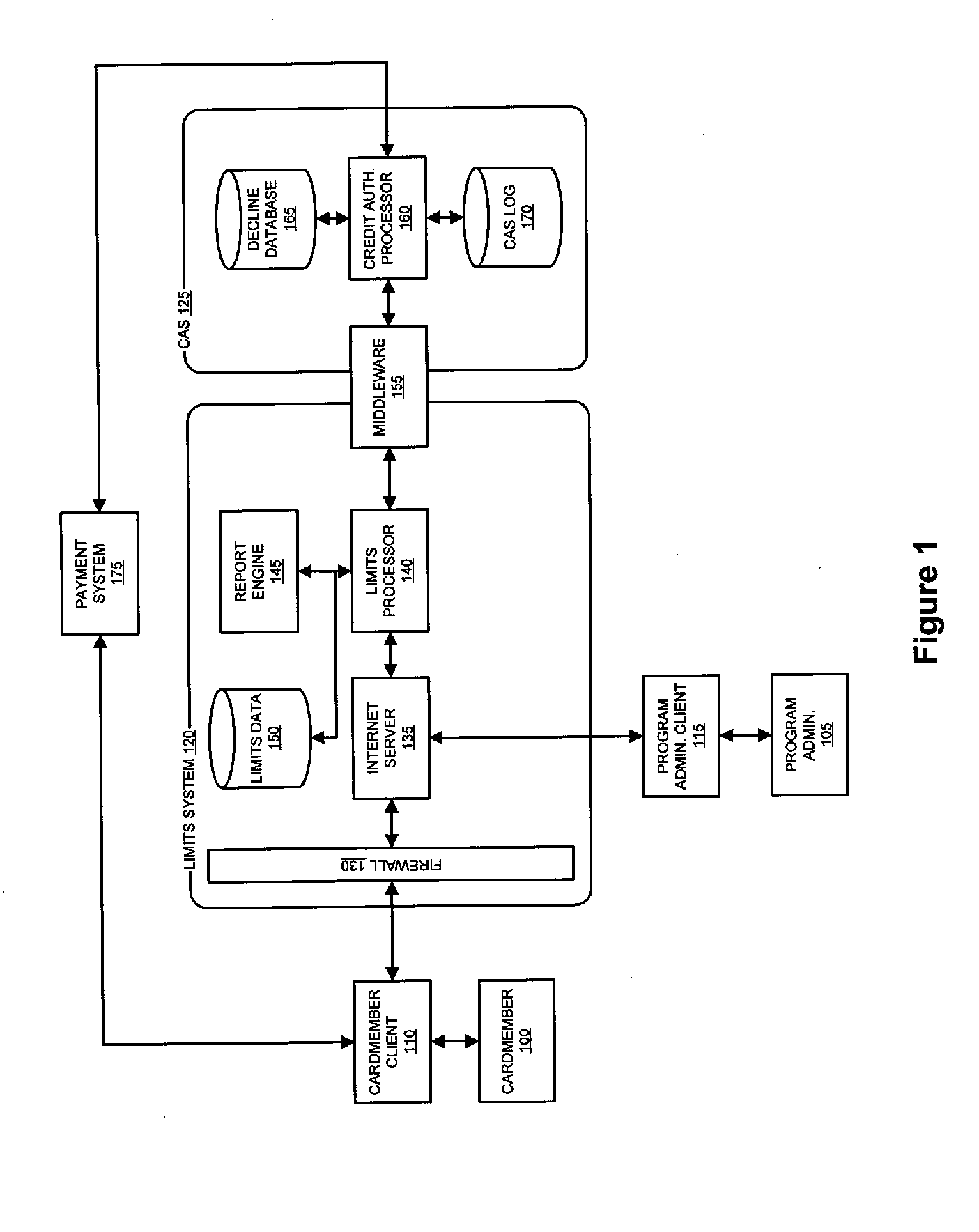

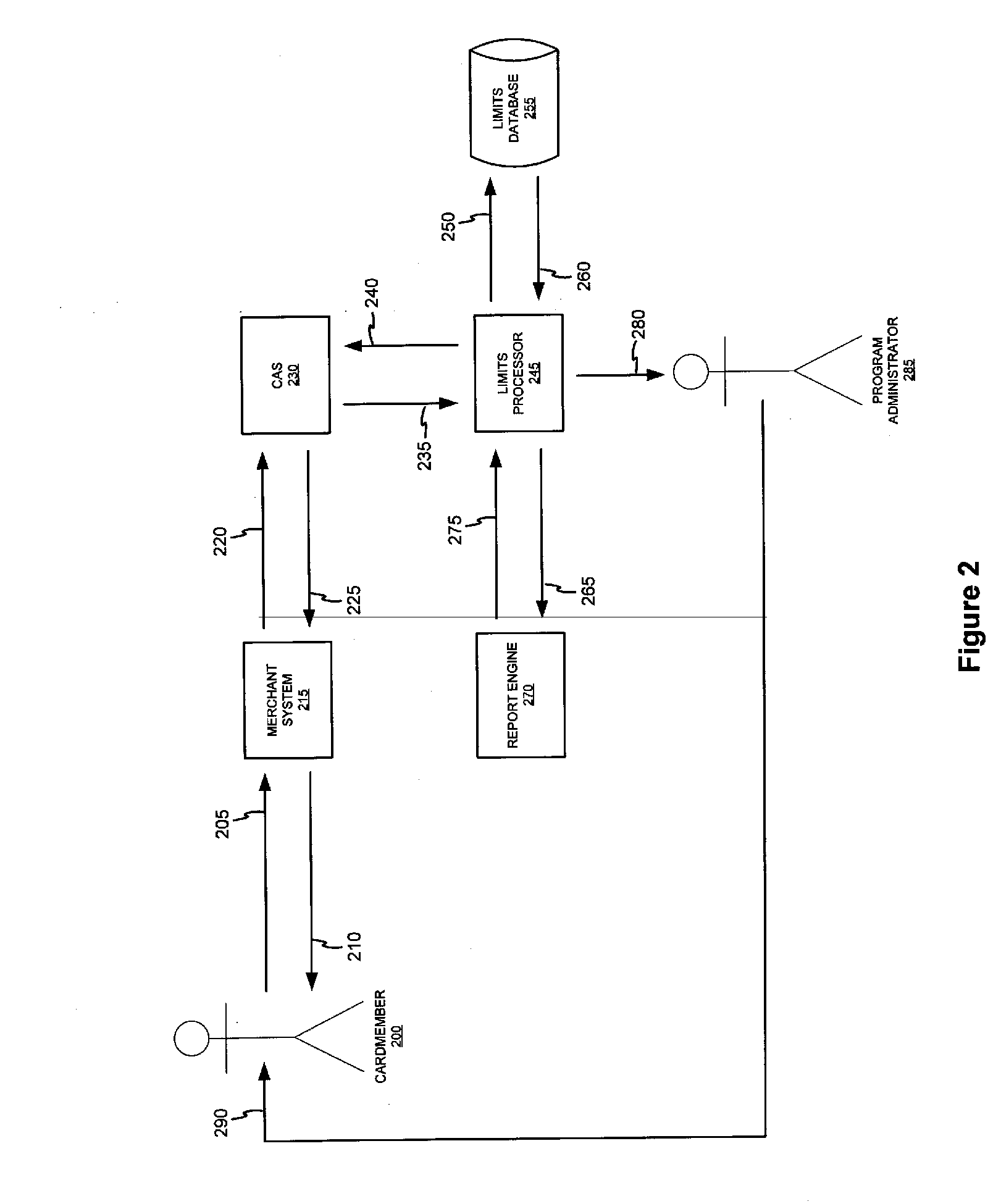

System and method for calculating recommended charge limits

InactiveUS20050279824A1Reduce POS declinesEasy to chargeFinanceBuying/selling/leasing transactionsPayment transactionCredit limit

The invention facilitates the compilation of client-imposed charge or credit limit reports based on declined purchase and / or payment transactions. The invention provides a system and method by which an account manager for a financial institution and / or a client program administrator company may perform analysis of spending patterns for cardmembers in order to determine an optimal client-imposed credit limit in order to reduce the occurrences of declined charge or credit transactions. An account manager for a financial institution and / or a client program administrator may use the limits report to persuade a cardmember to increase the client-imposed credit limit to a recommended level, thereby reducing the cardmember's inconvenience cased by declined purchase transactions while recapturing lost revenues by the card issuer also resulting from declined purchase transactions.

Owner:LIBERTY PEAK VENTURES LLC

Credit handling in an anonymous trading system

InactiveUS7024386B1Reduce the amount requiredReduce capacityFinancePayment architectureEngineeringCredit limit

In an anonymous trading system, credit between counterparties is effectively increased by netting buy and sell trades to reflect the true risk to which each party is exposed. Credit limits are adjusted by calculating the exposure in each currency at the relevant time and then converted into the credit limit currency equivalent. The credit limits are adjusted accordingly. The resulting credit limits may be different for bids and offers by or from a given counterparty.

Owner:CME GRP

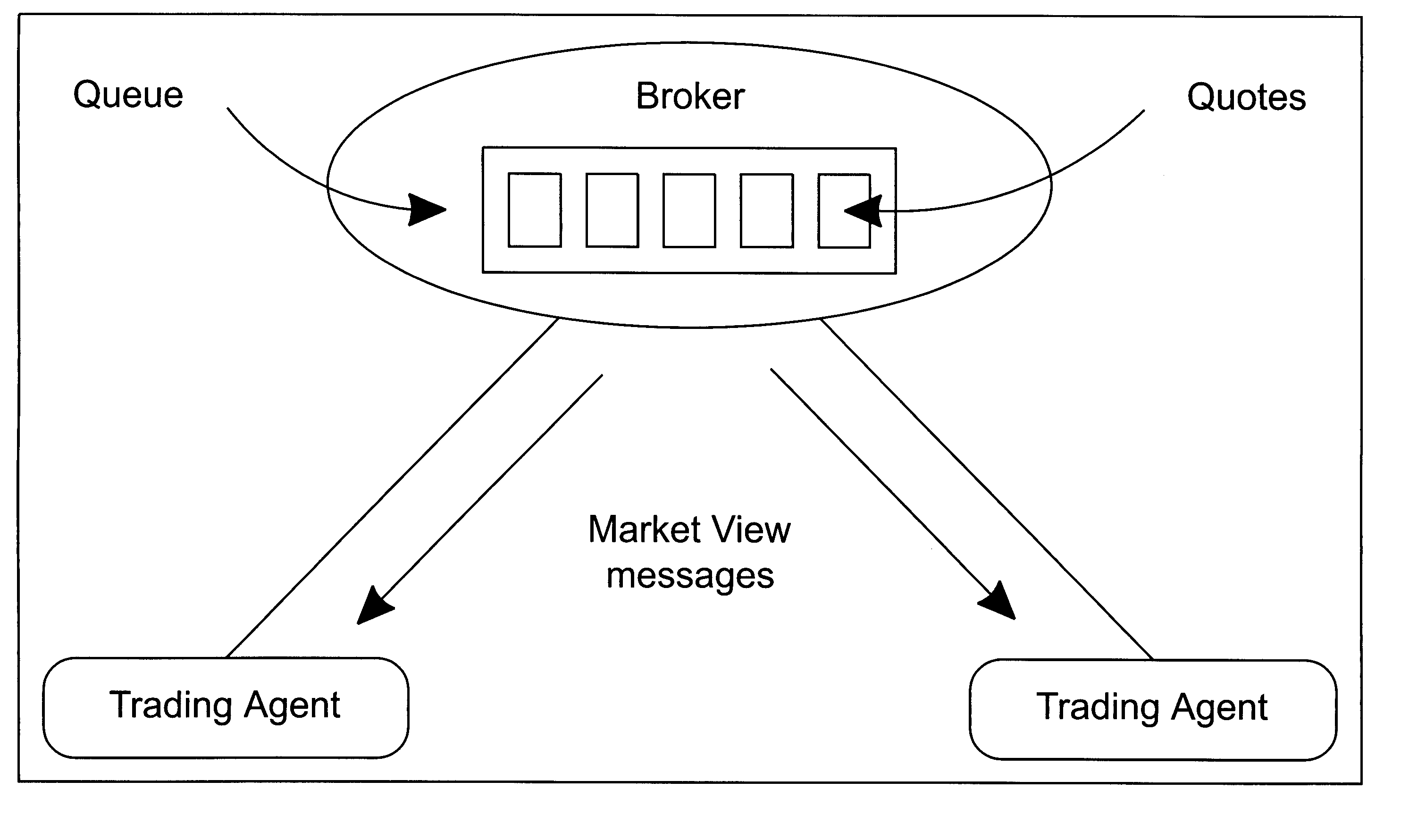

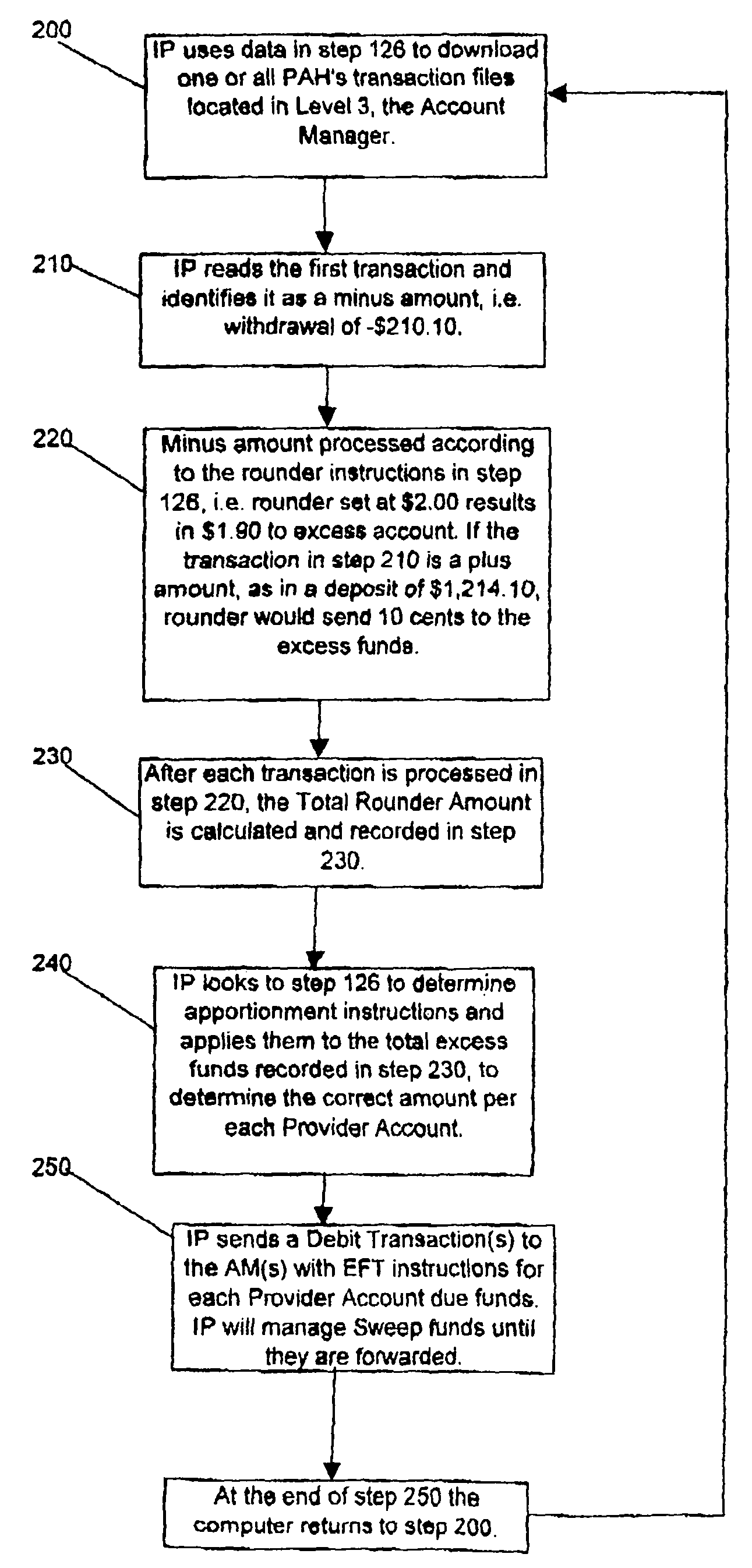

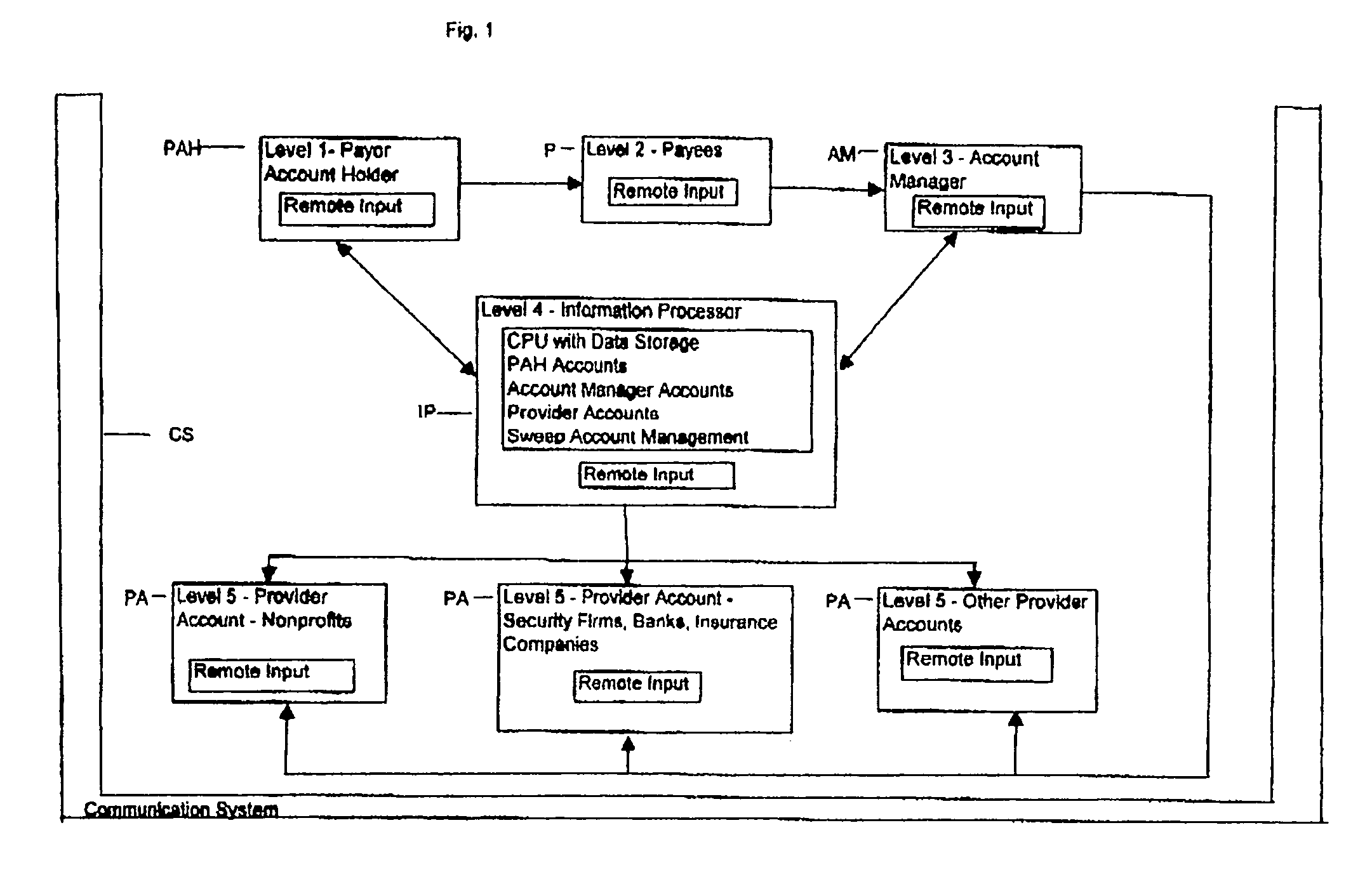

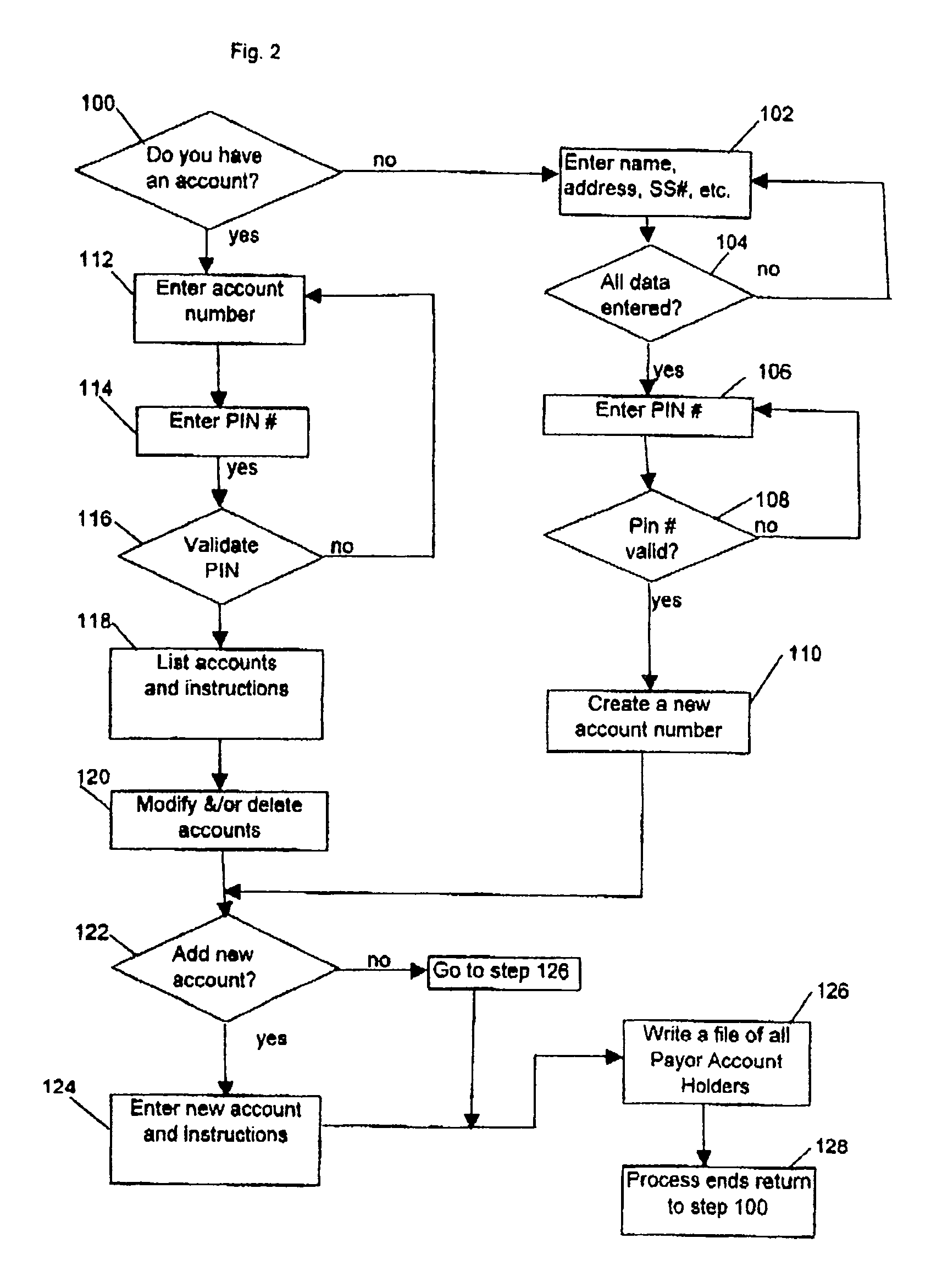

Creation and distribution of excess funds, deposits, and payments

Accumulating credits from financial movements to and from accounts held by a financial transactor and managed by an account manager involves initiating a roundup by periodically accessing entries in the account with an information processor to round up entries in the account, rounding up the entries in the account to obtain a total roundup amount, withdrawing the roundup amount from the account and debiting the account with the roundup amount. In one embodiment the information processor is external to and out of control of the account manager. At non-bank and bank locations send deposits and payments, in cash and / or checks, to financial institutions by using a remote input to truncate the paper checks and the cash used in the transaction.

Owner:ACORNS GROW

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com