Patents

Literature

69 results about "Balance transfer" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A balance transfer is the transfer of (part of) the balance (either of money or credit) in an account to another account, often held at another institution. It is most commonly used when describing a credit card balance transfer.

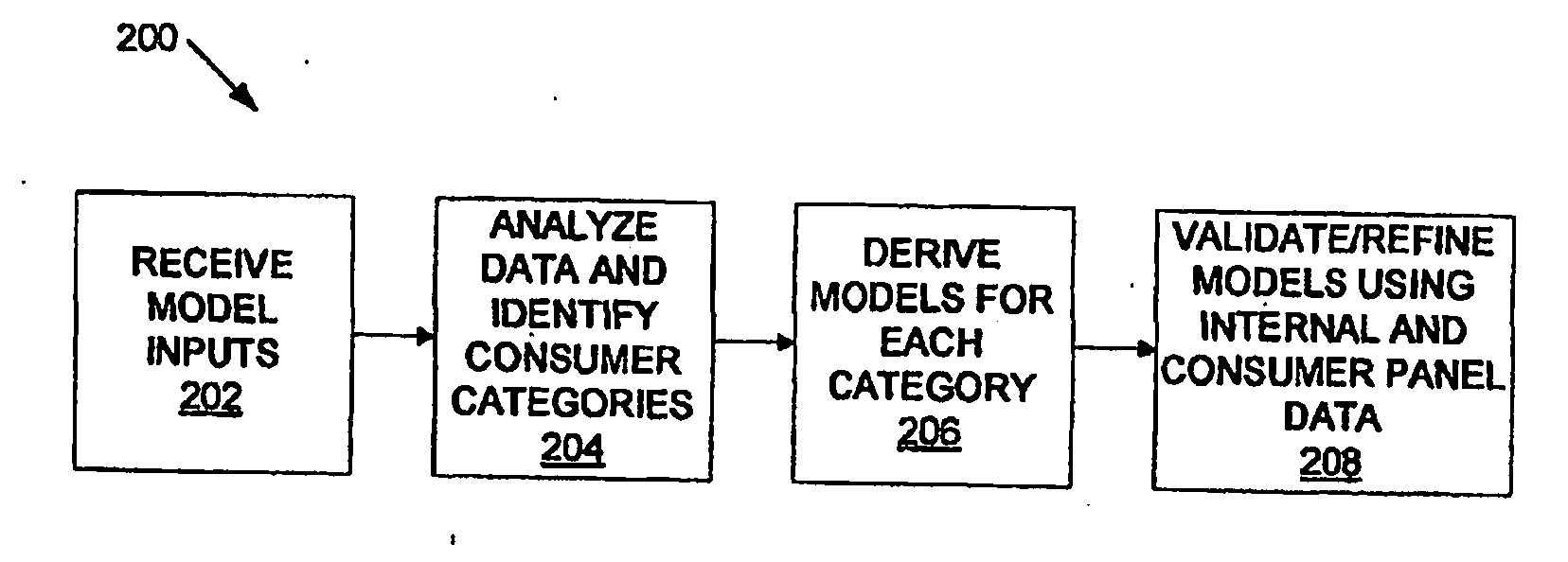

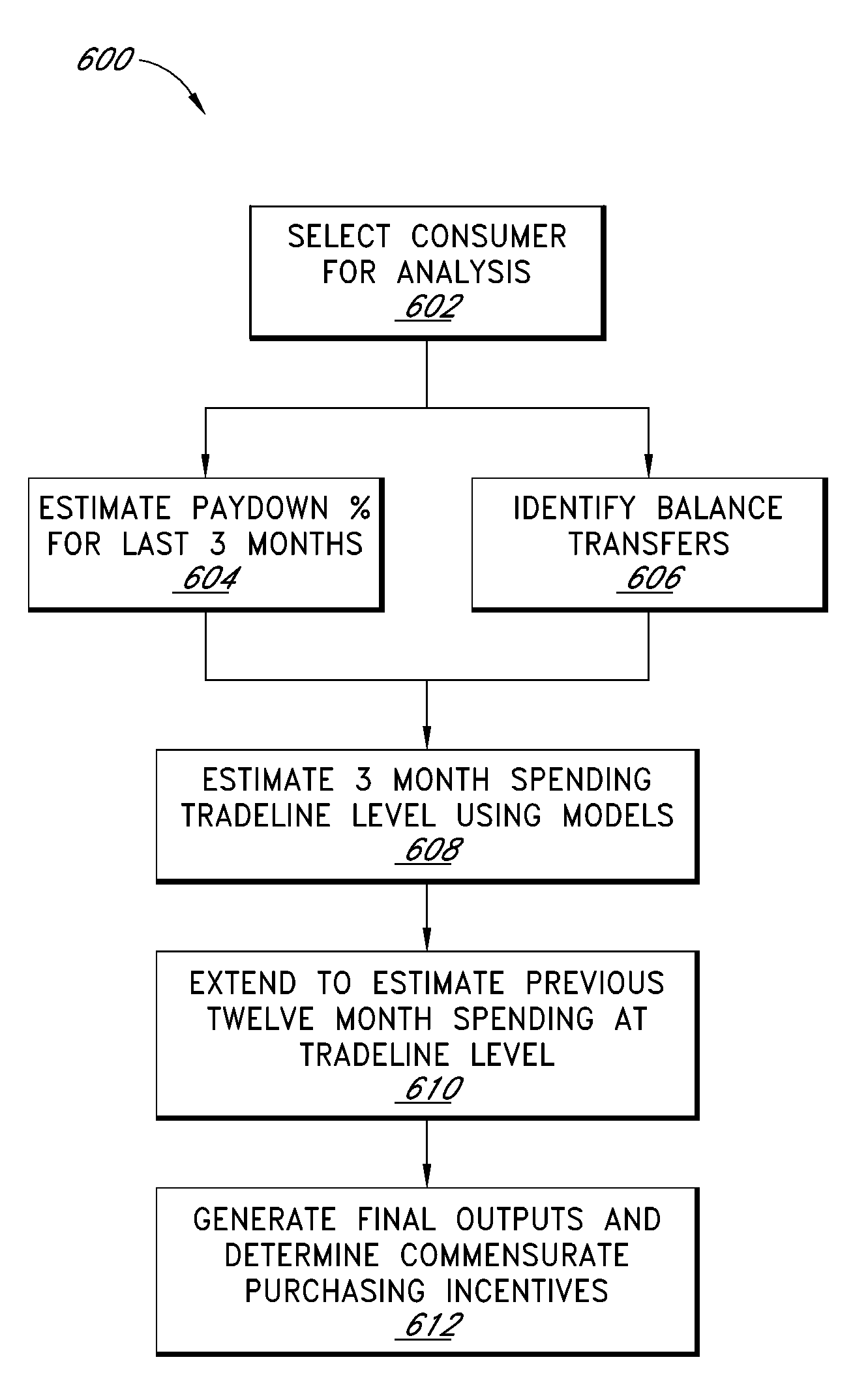

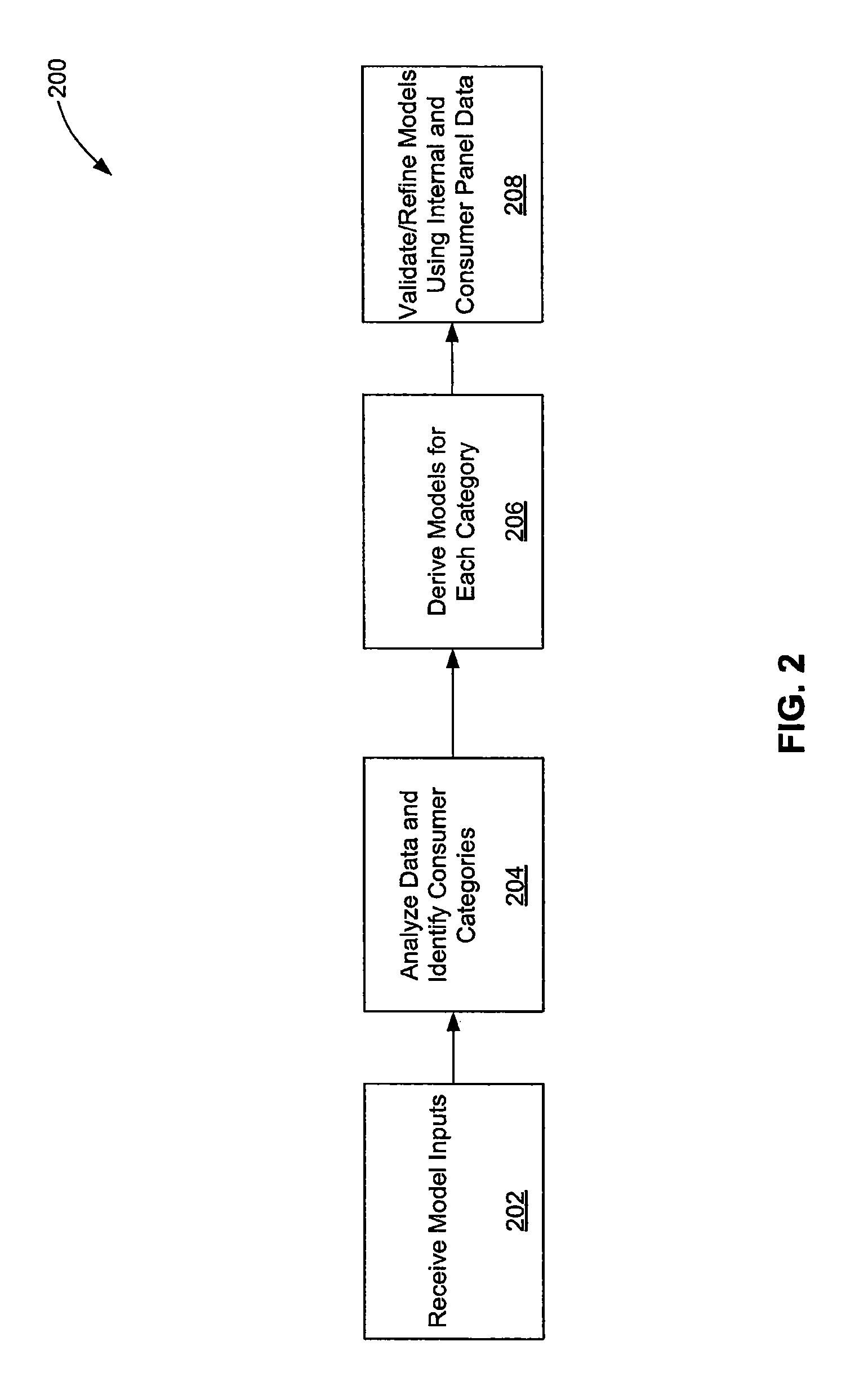

Method and apparatus for consumer interaction based on spend capacity

ActiveUS20060242046A1Efficient use ofEfficient managementFinancePayment architectureBalance transferInsurance life

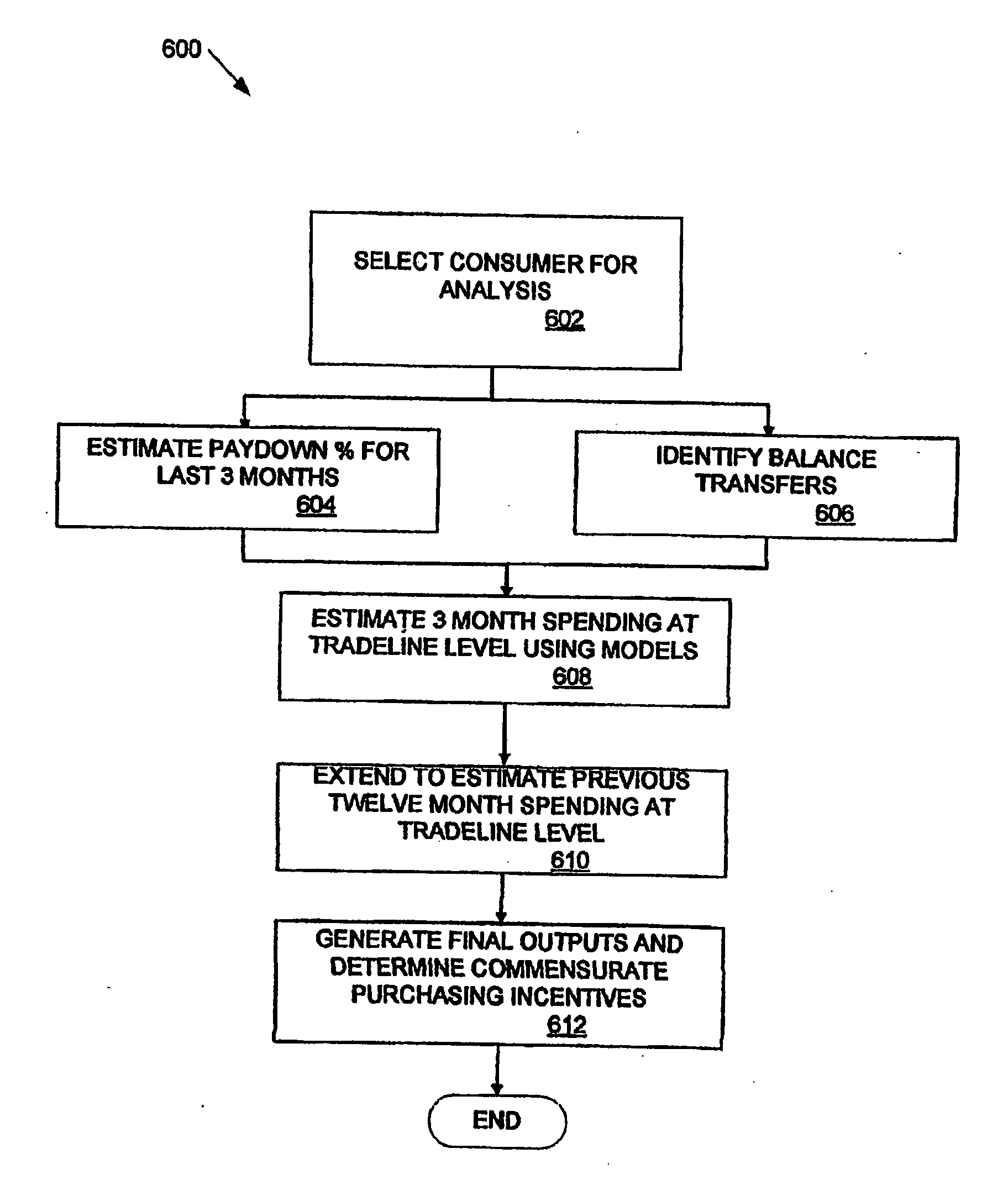

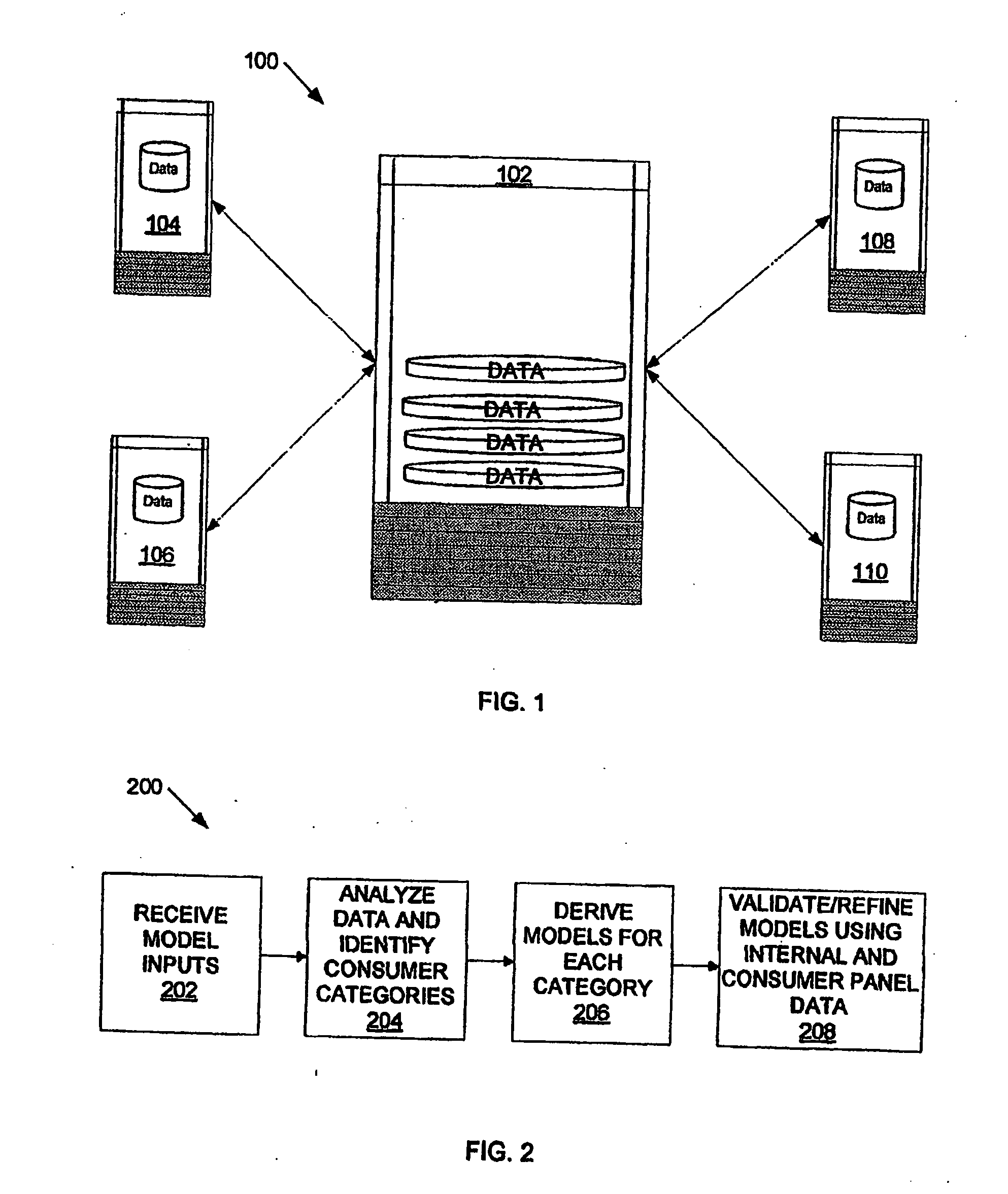

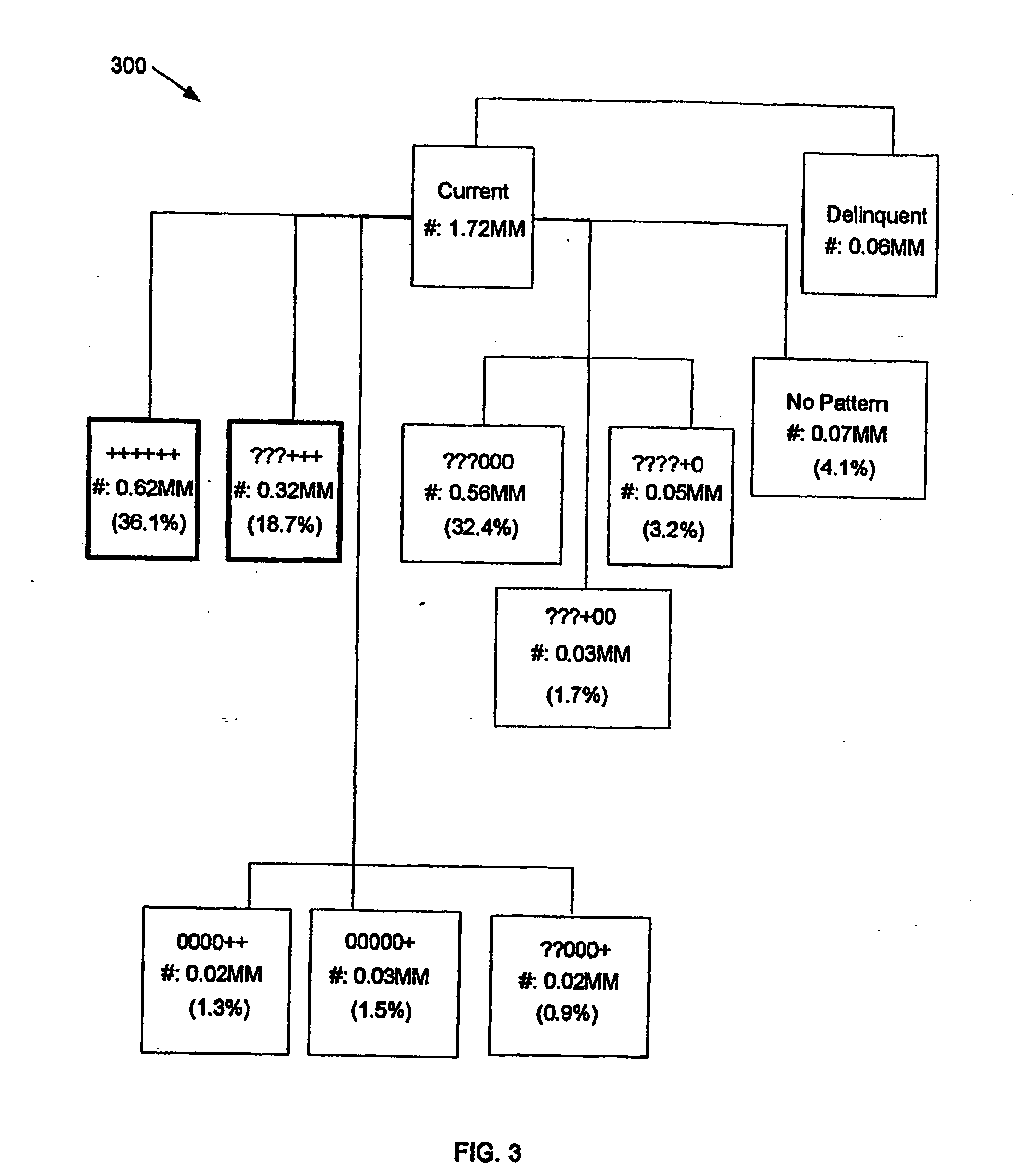

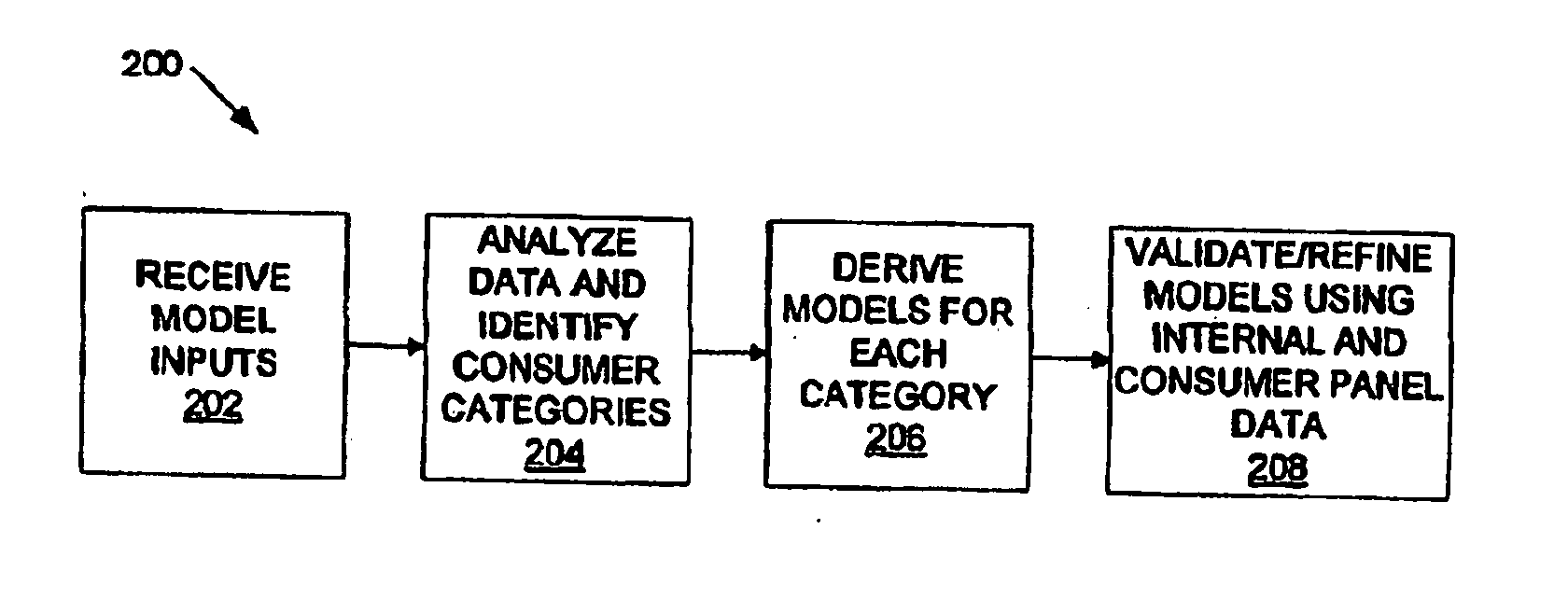

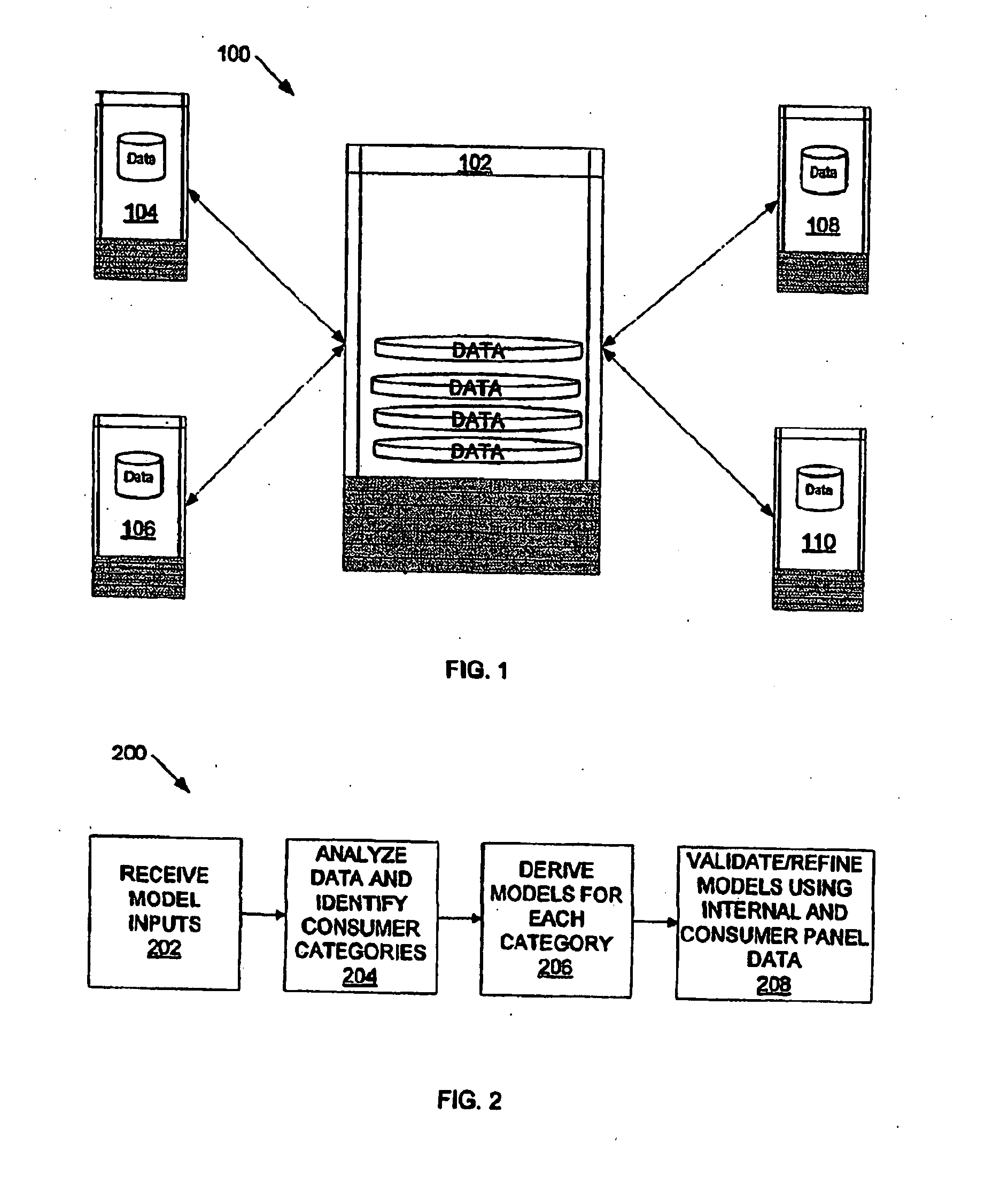

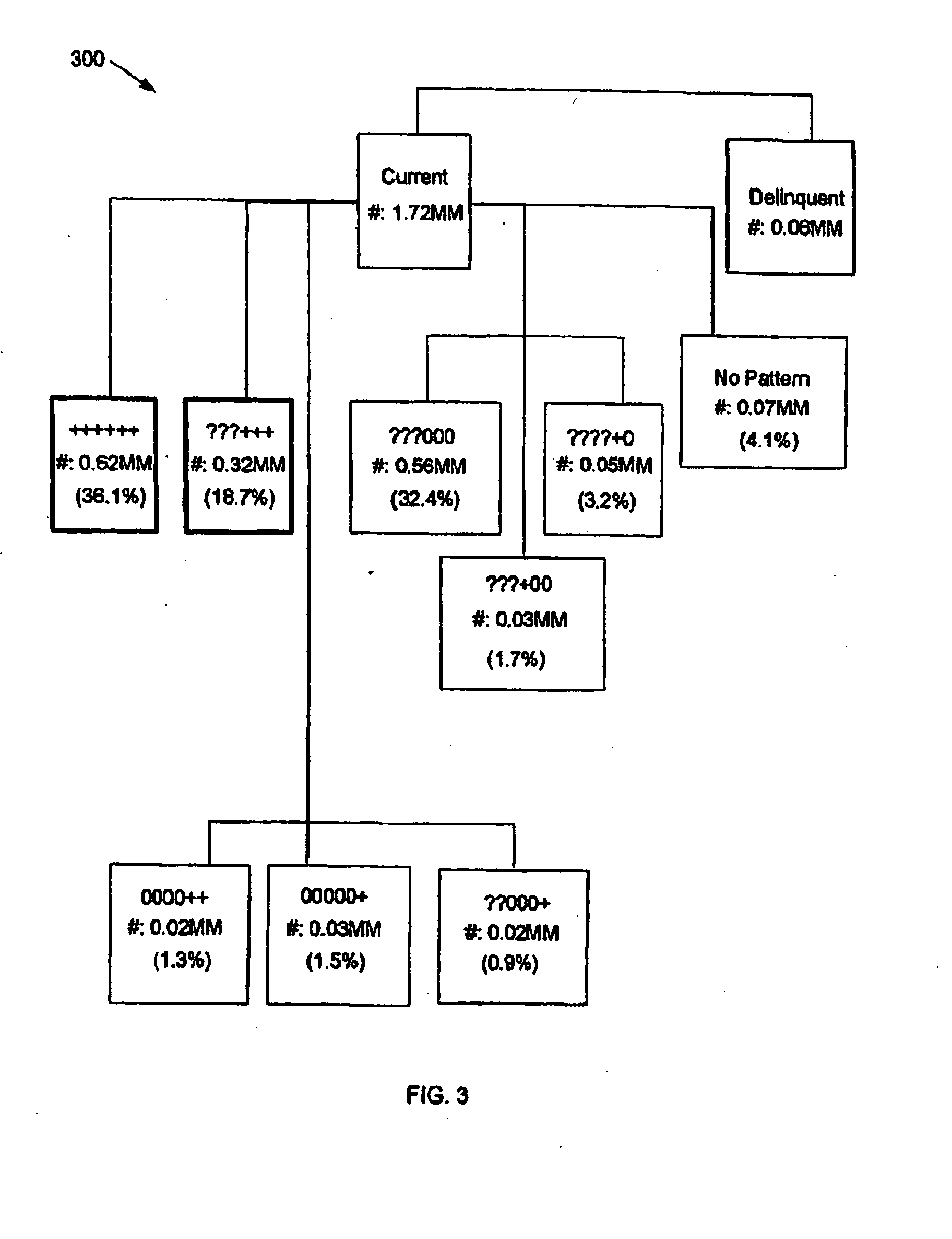

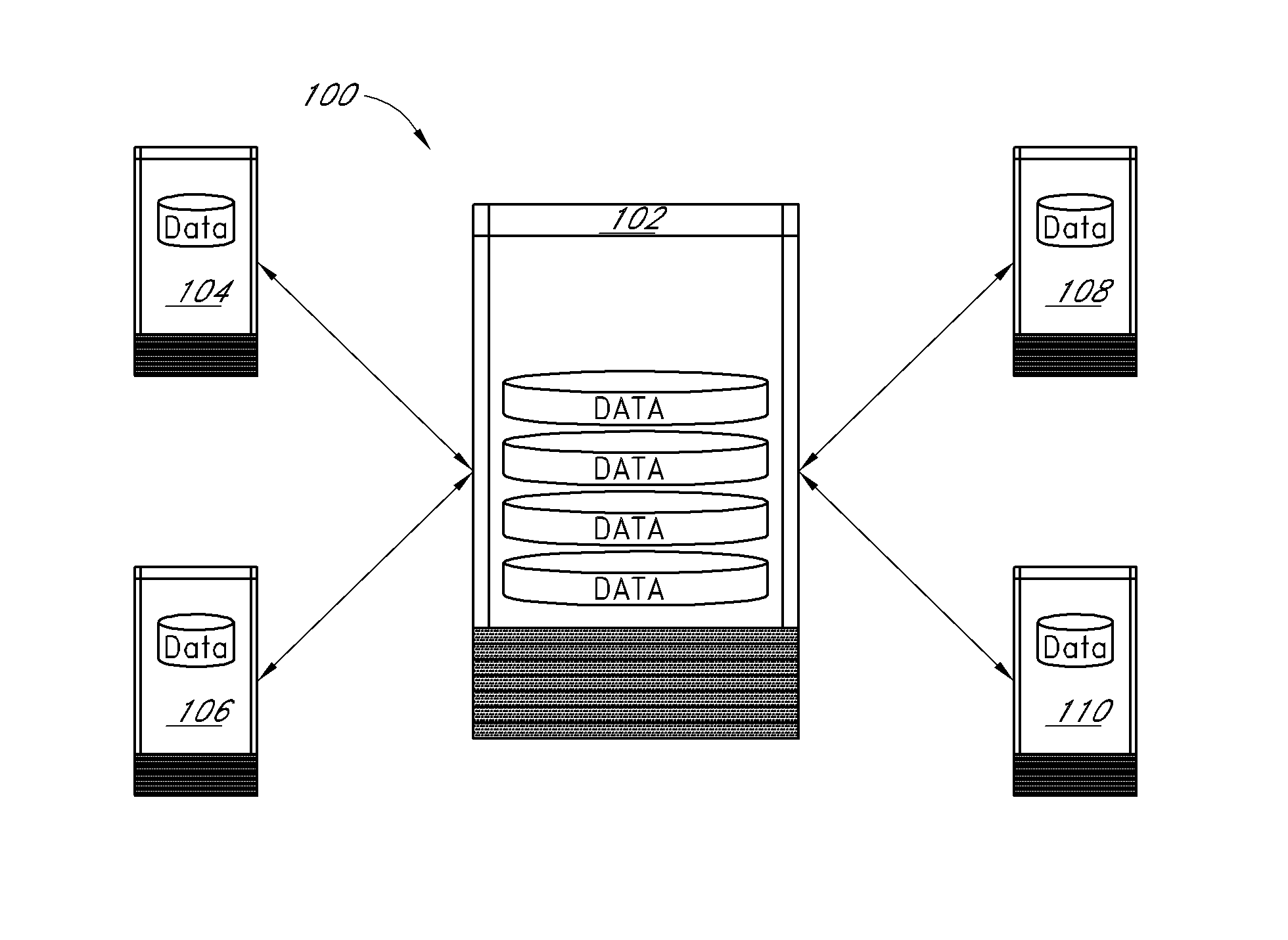

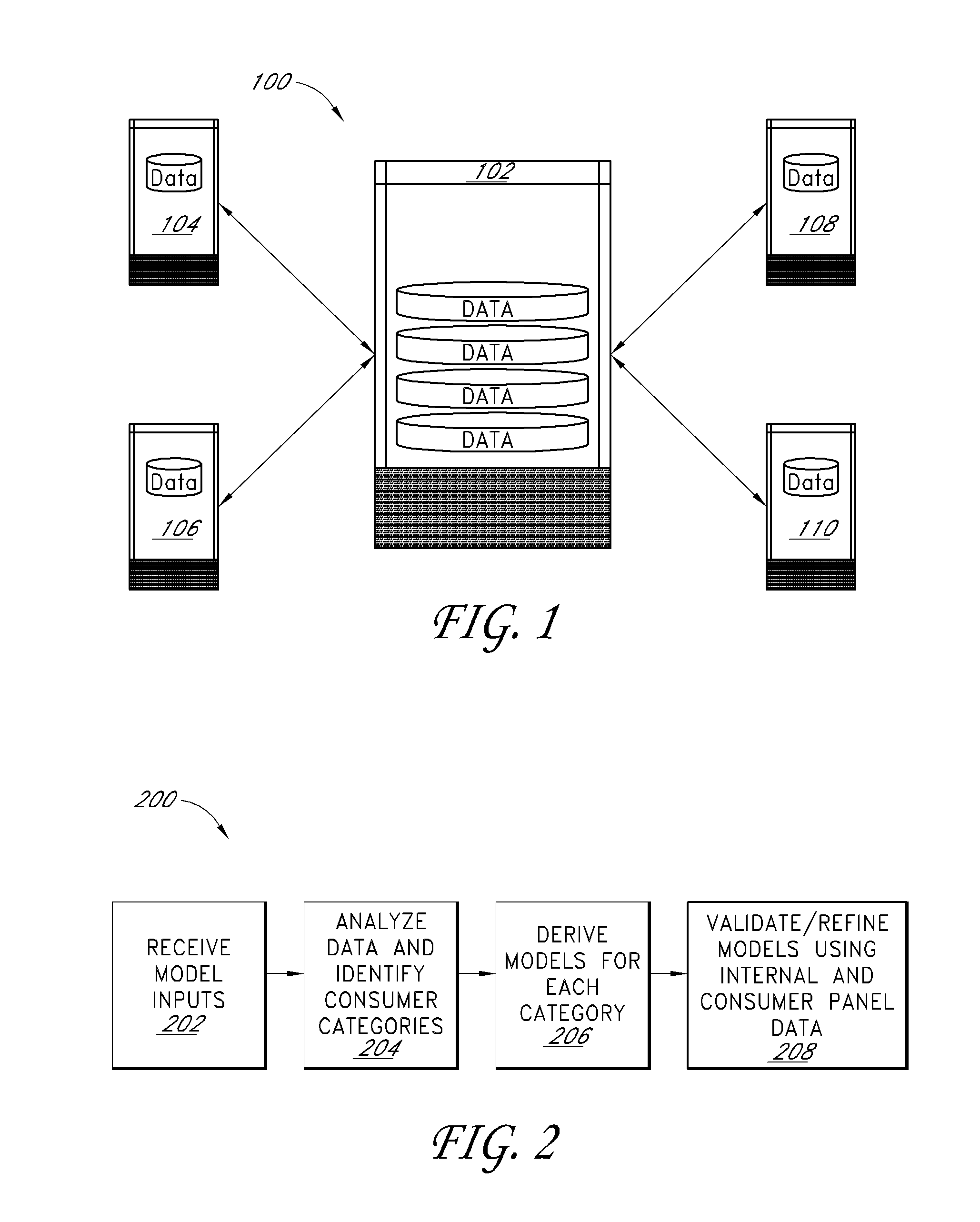

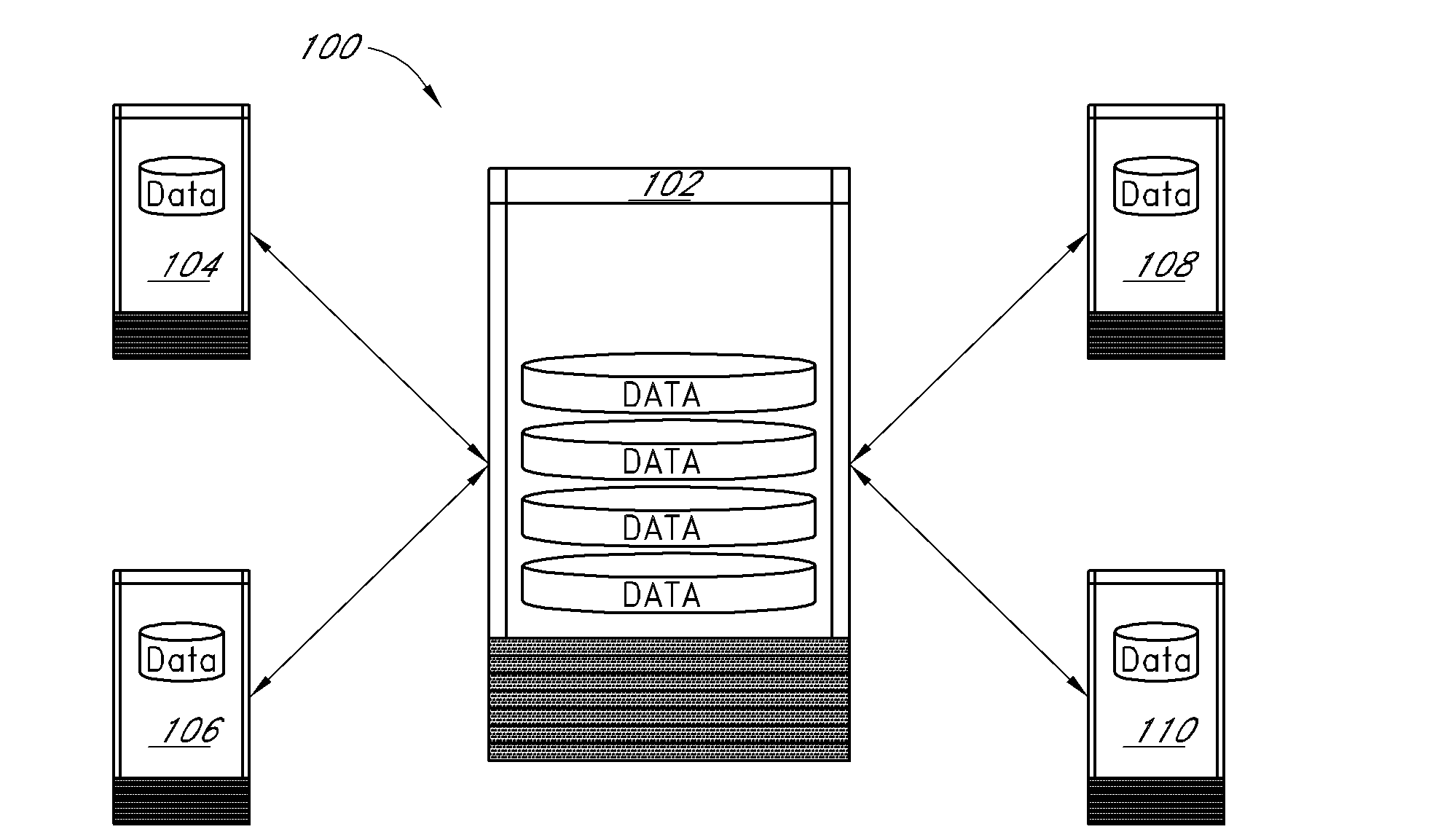

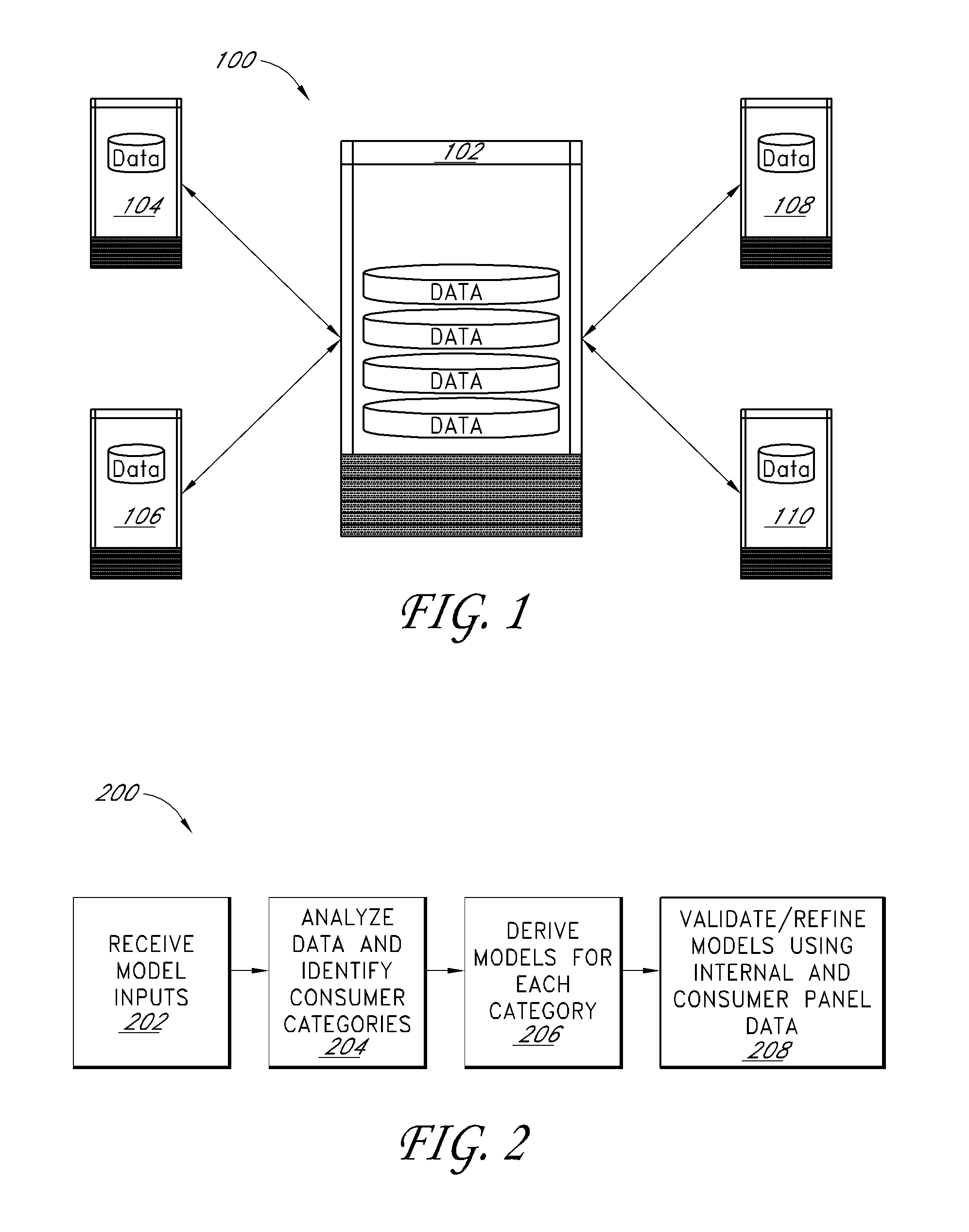

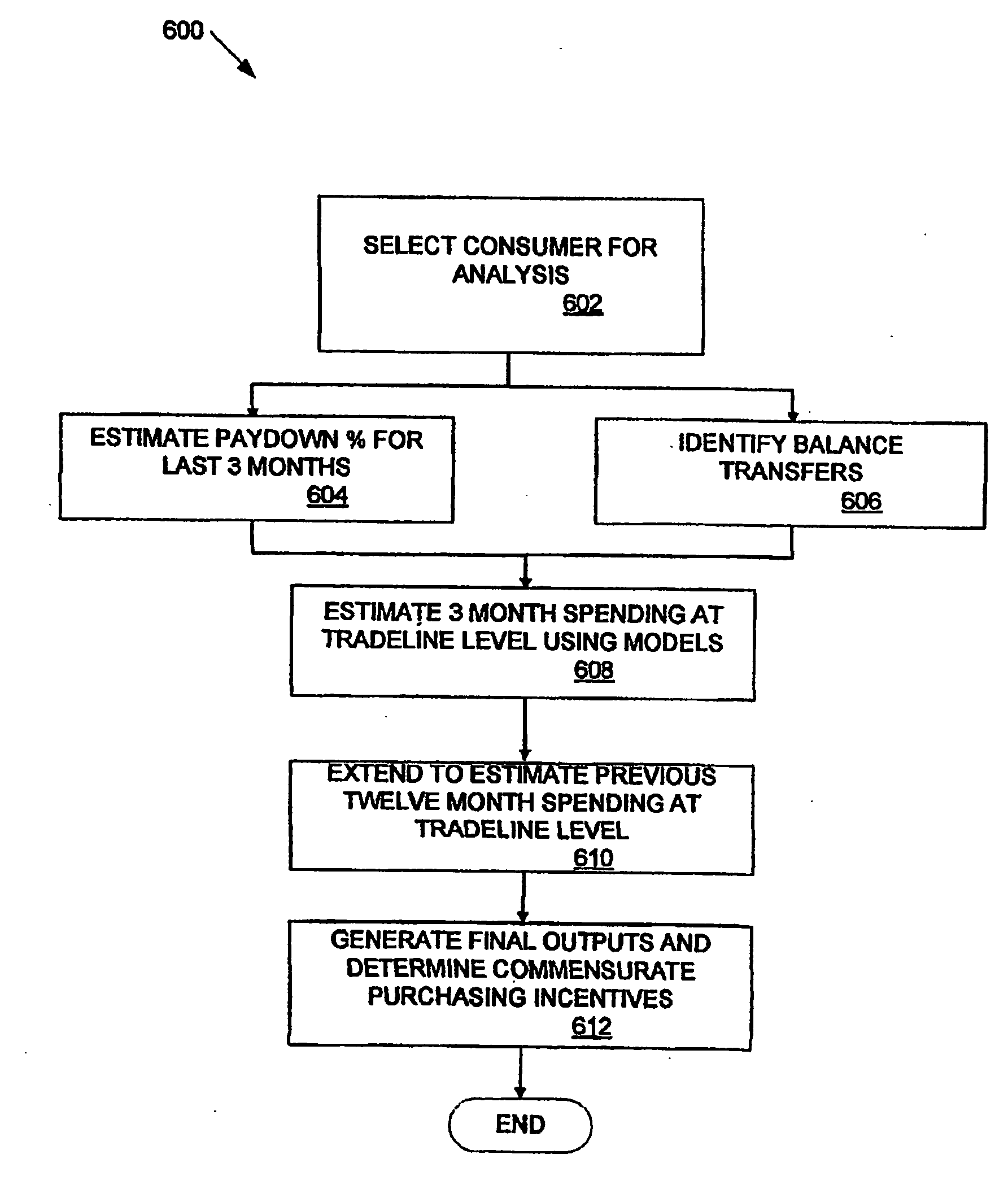

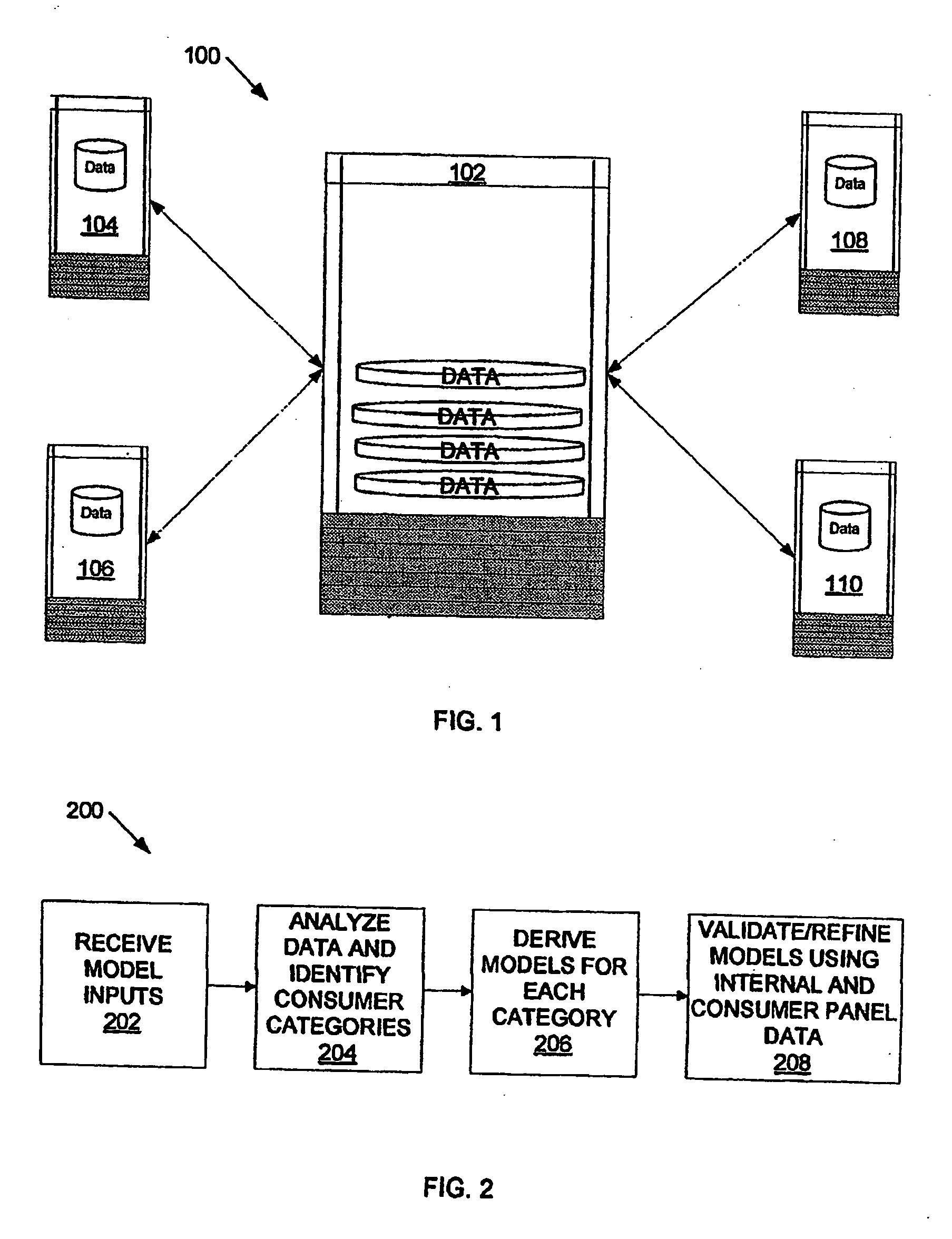

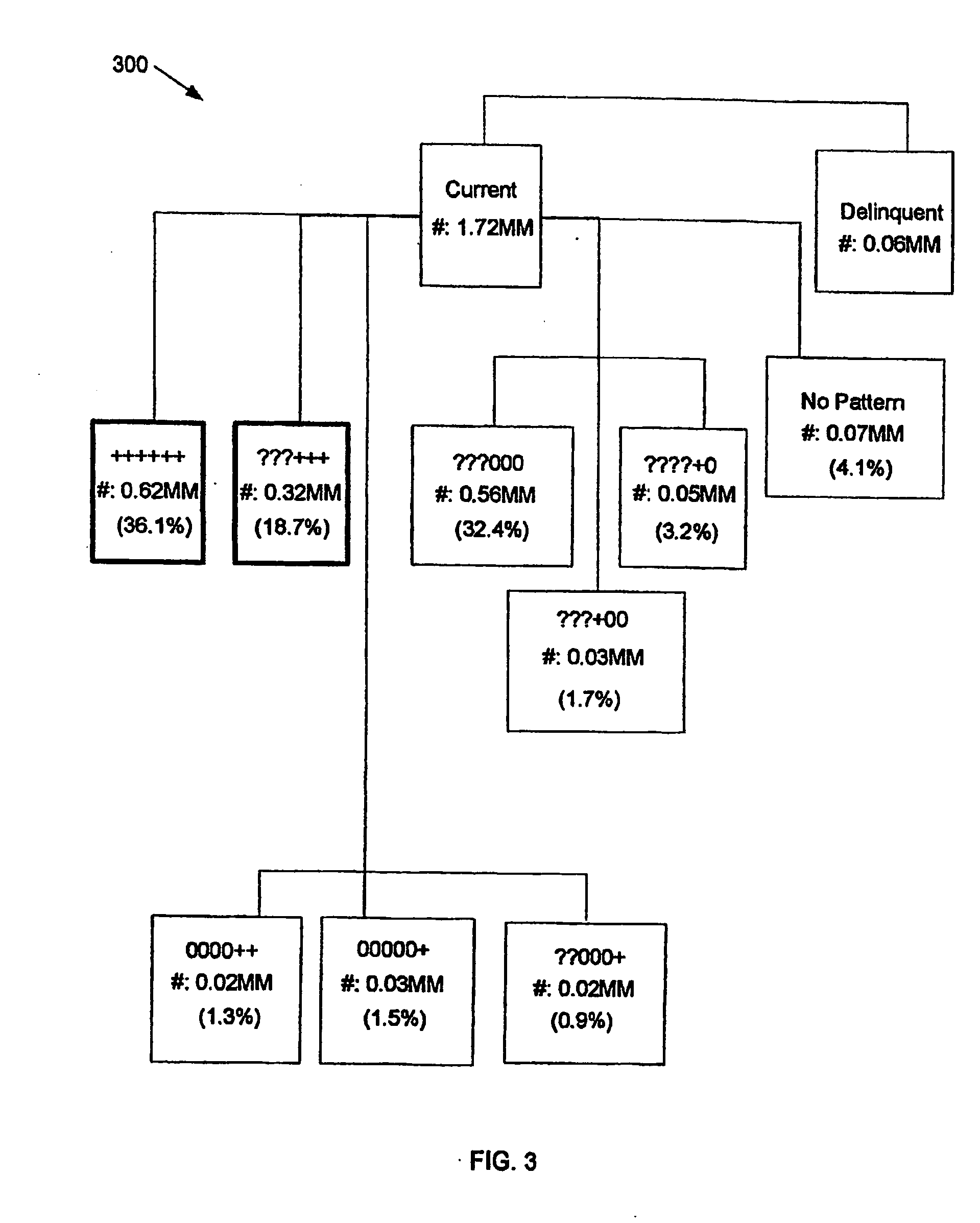

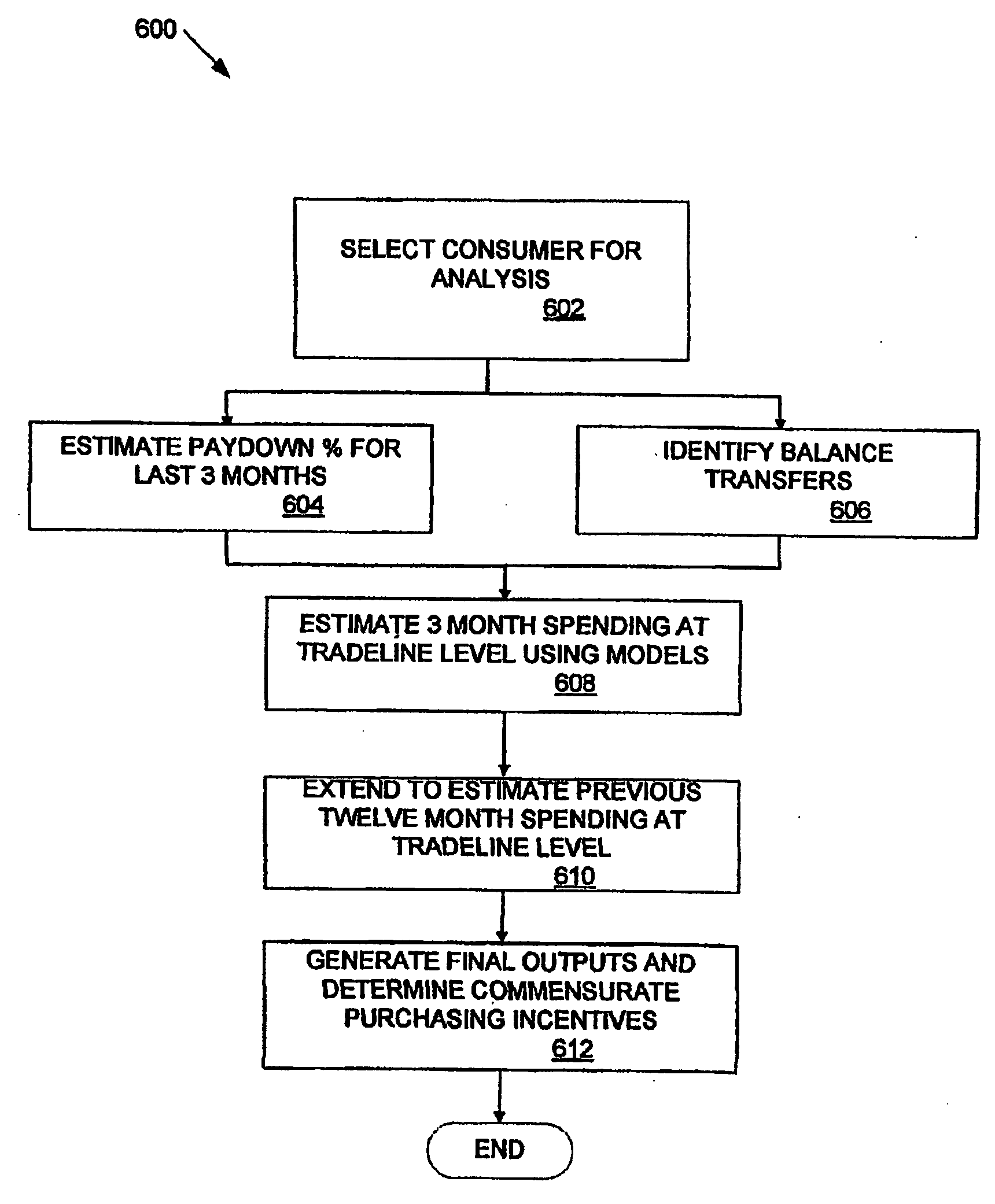

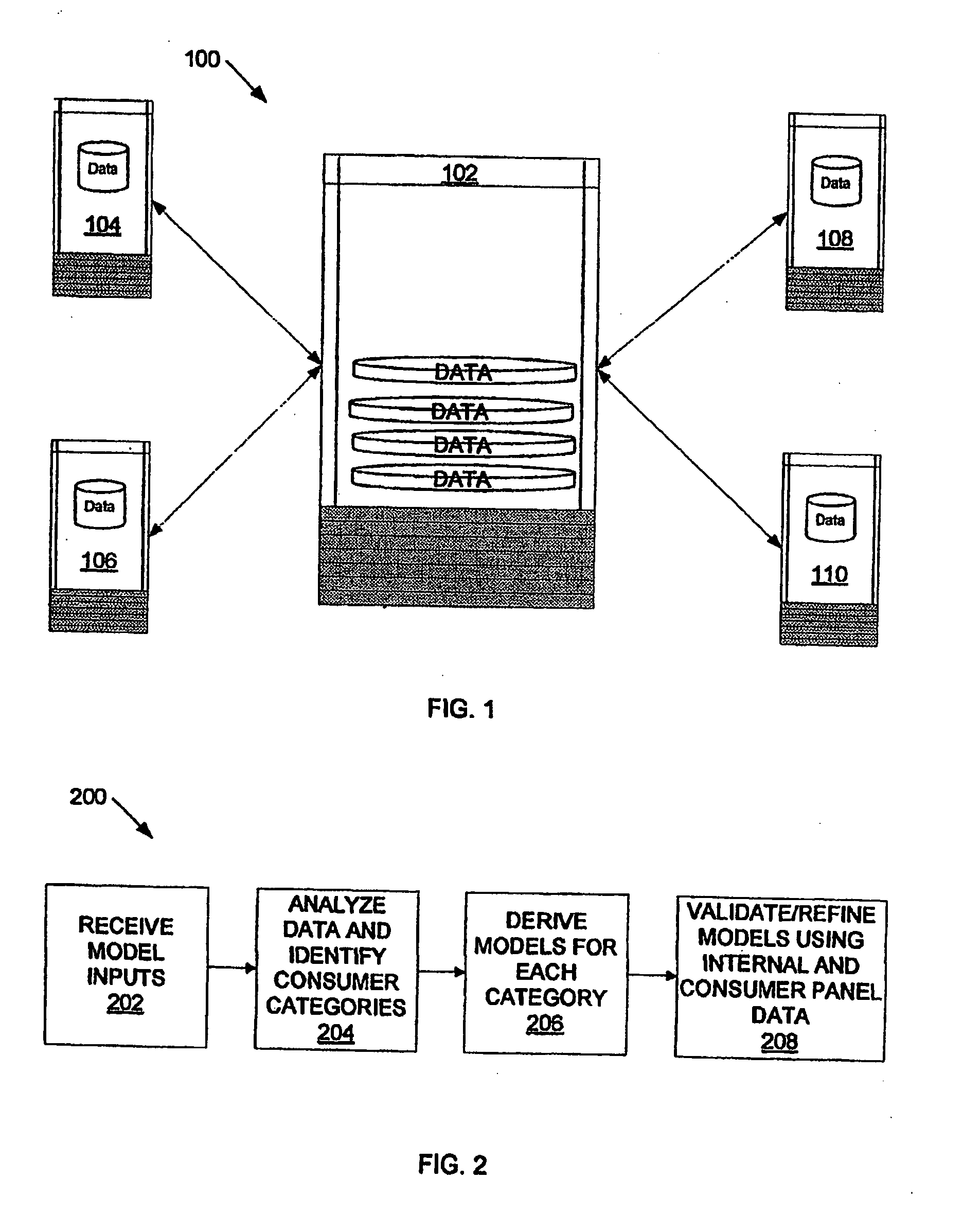

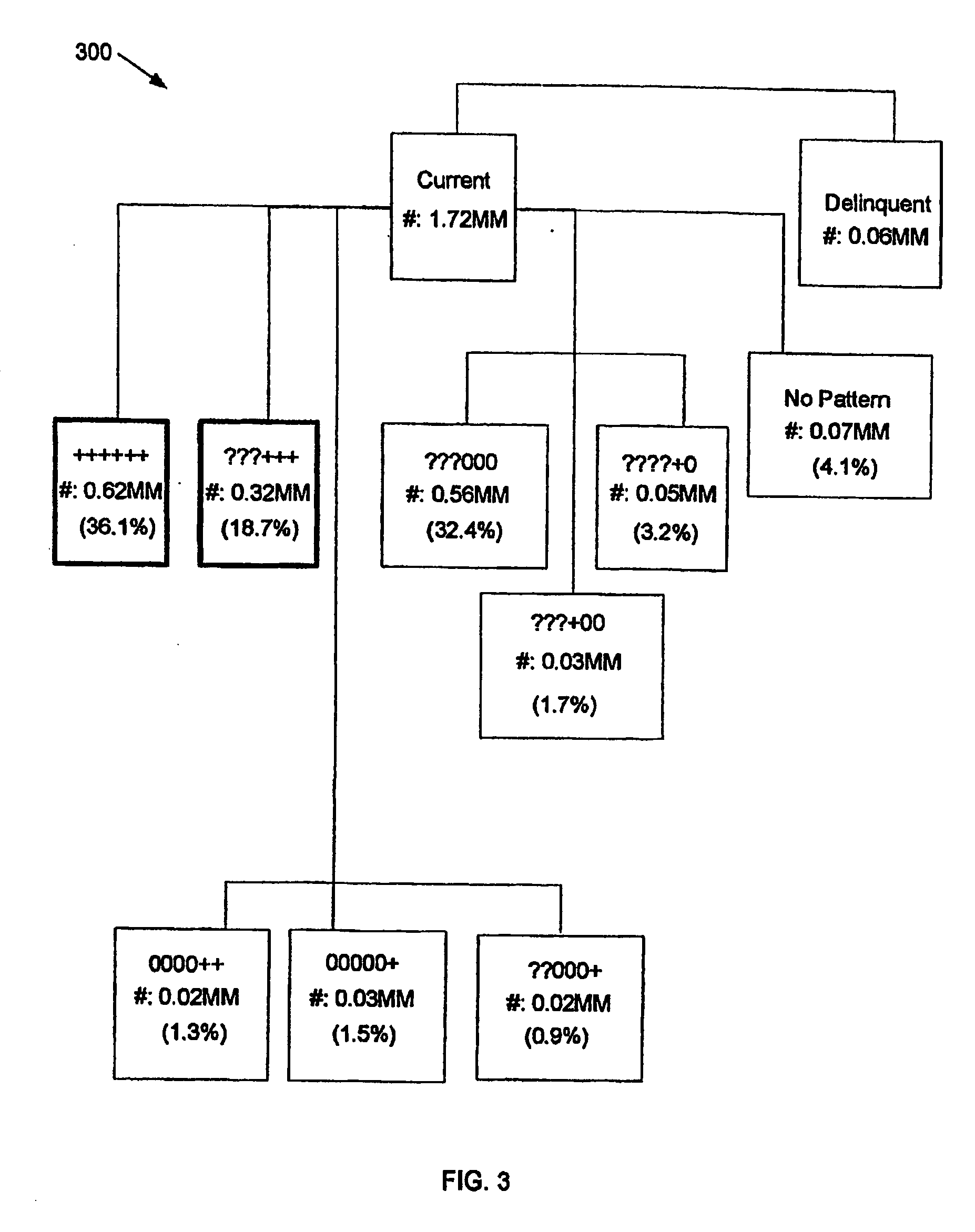

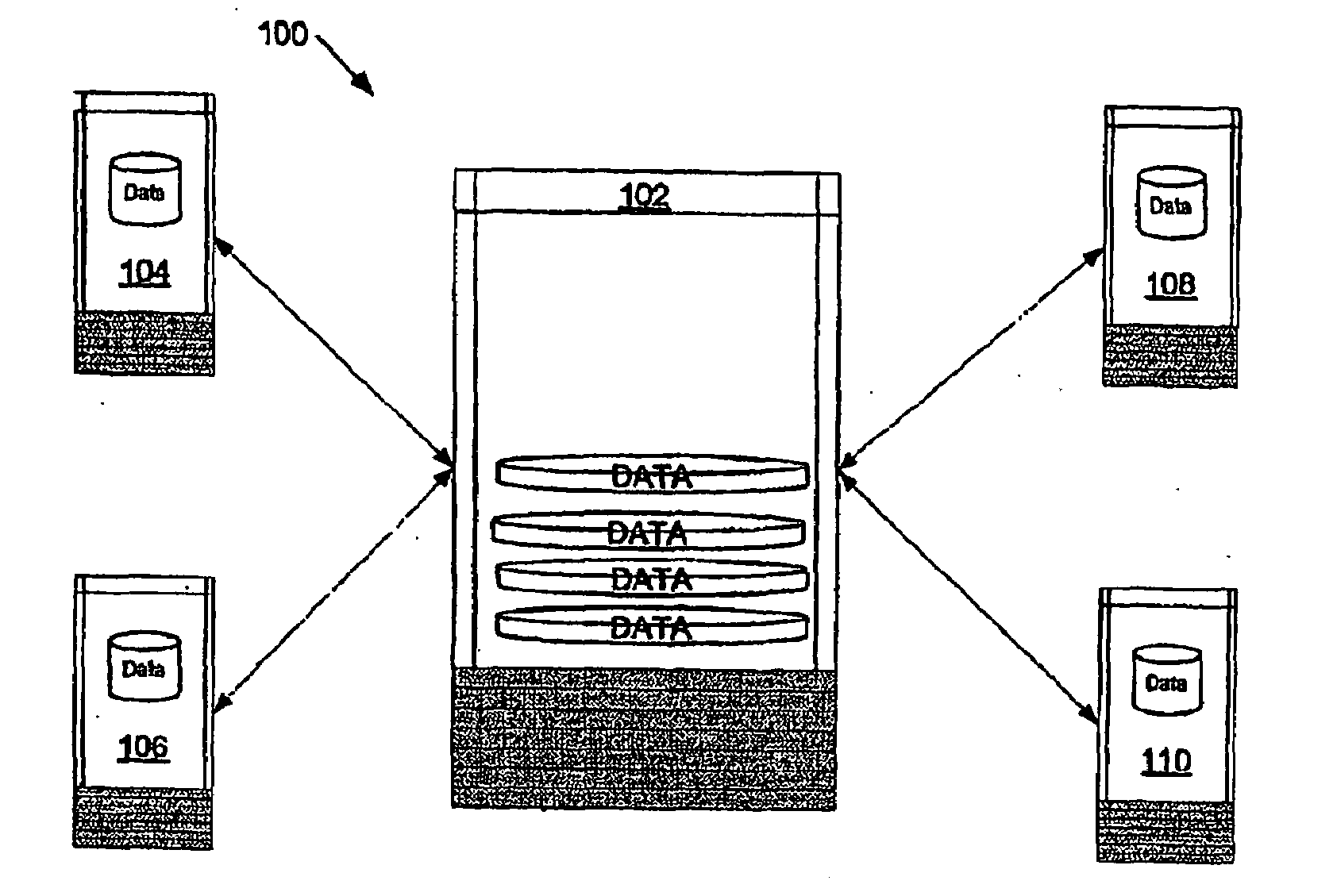

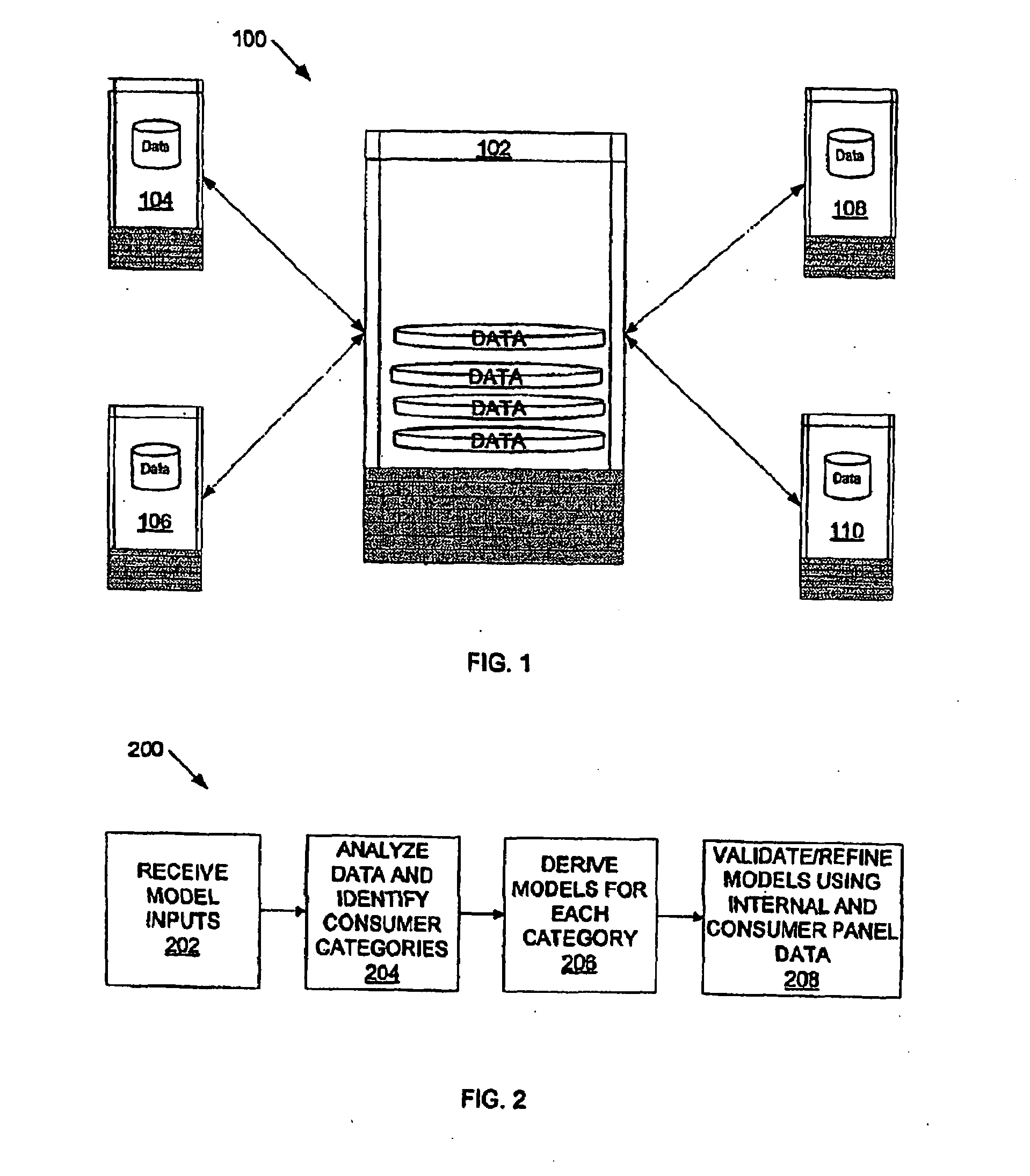

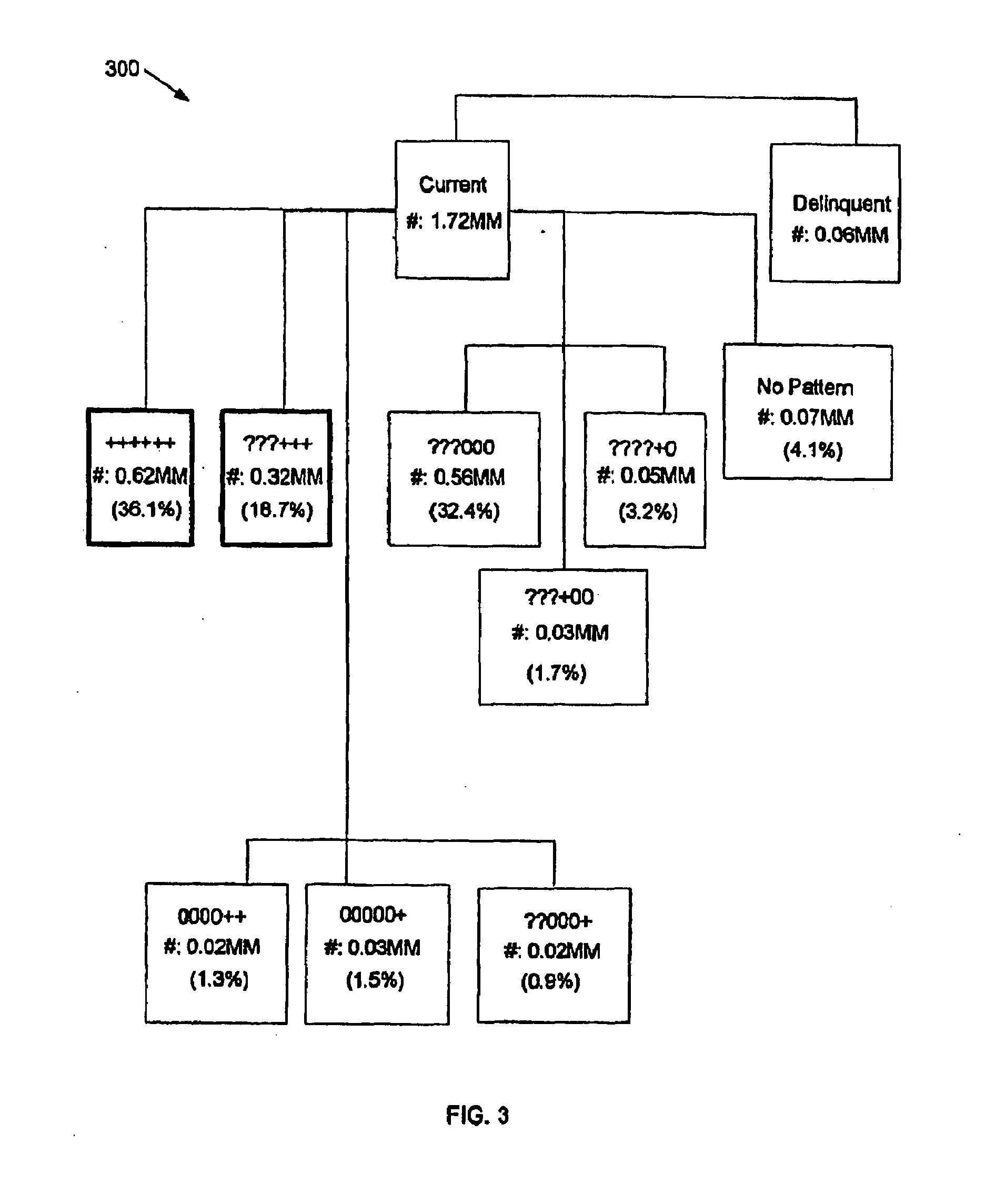

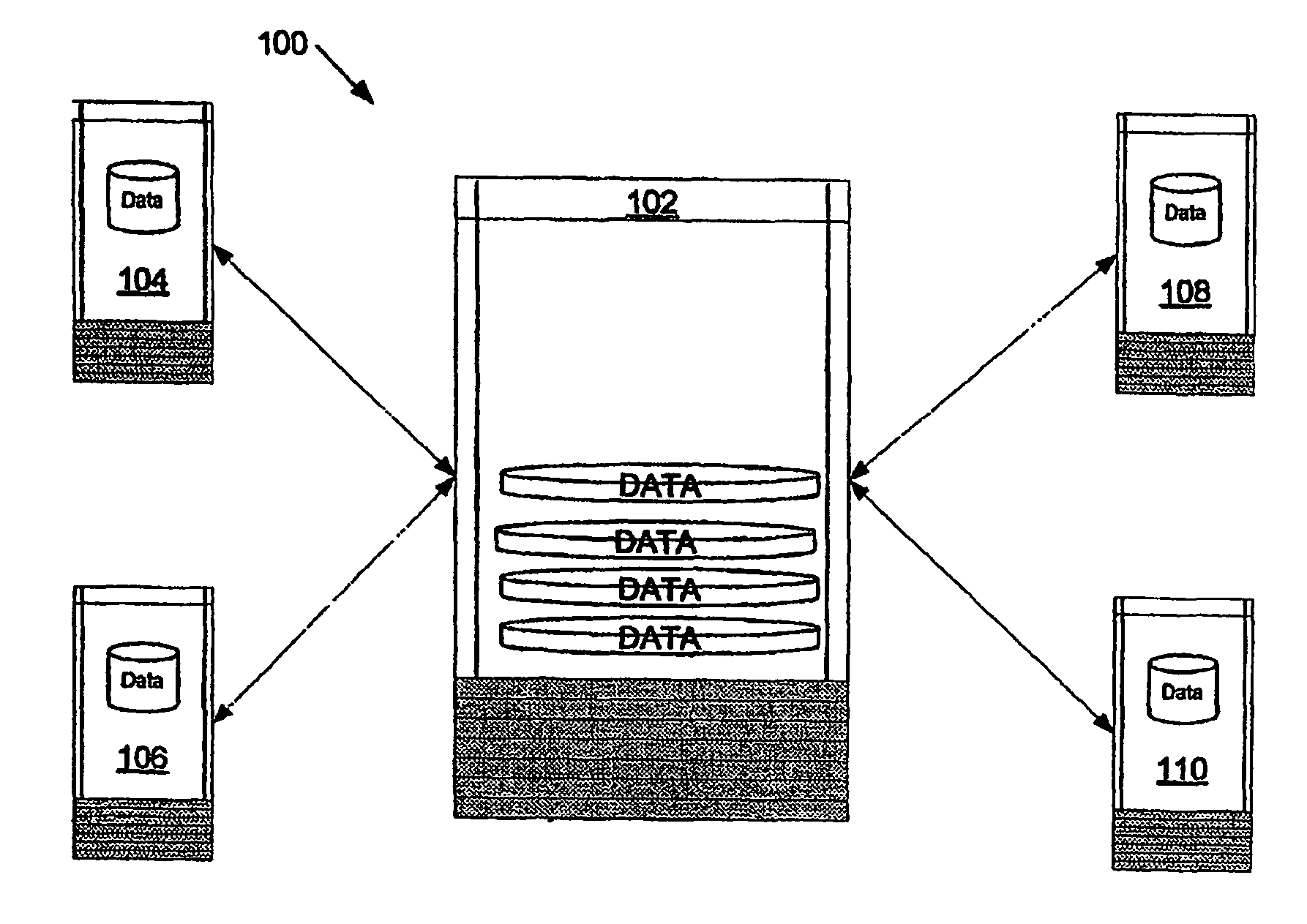

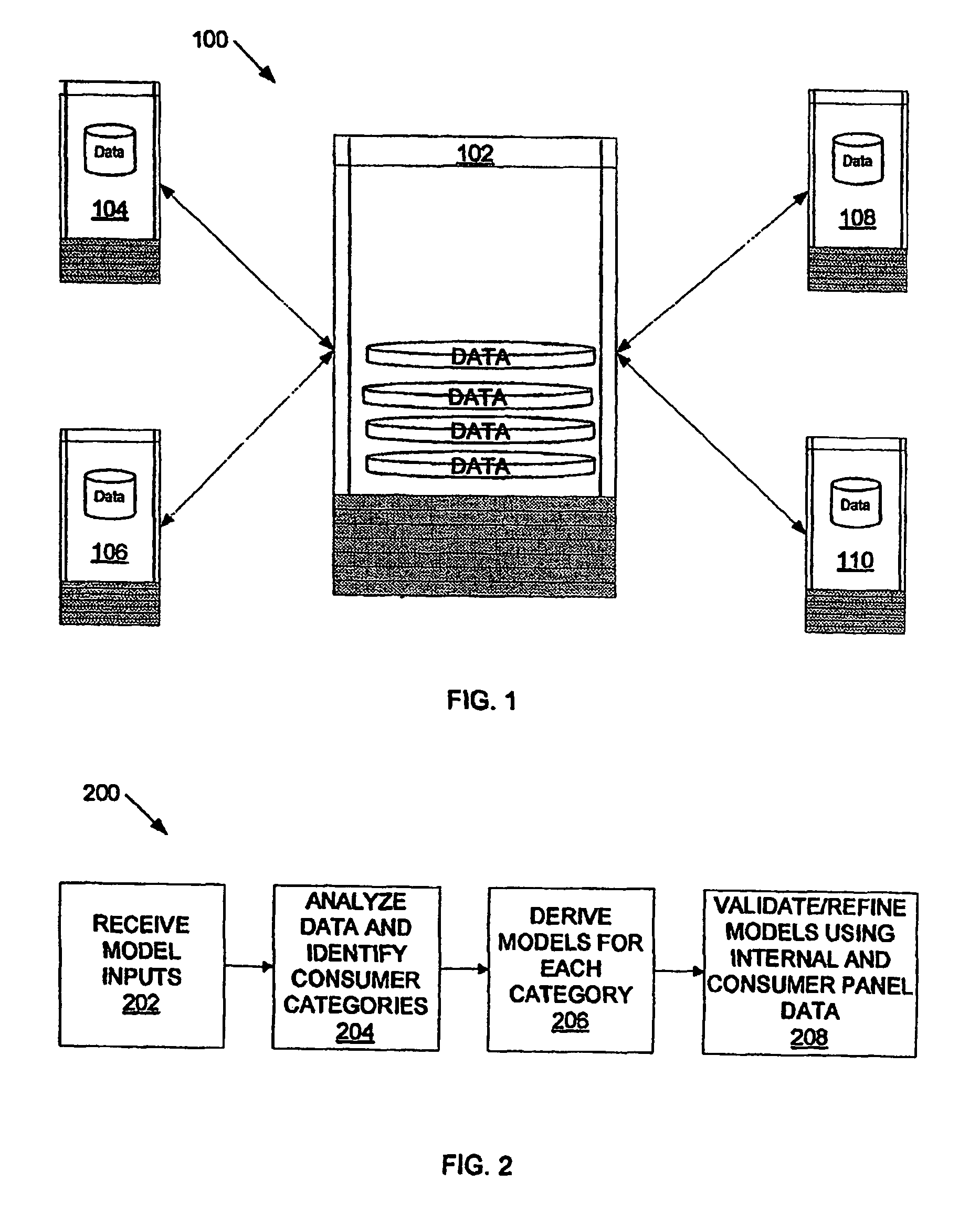

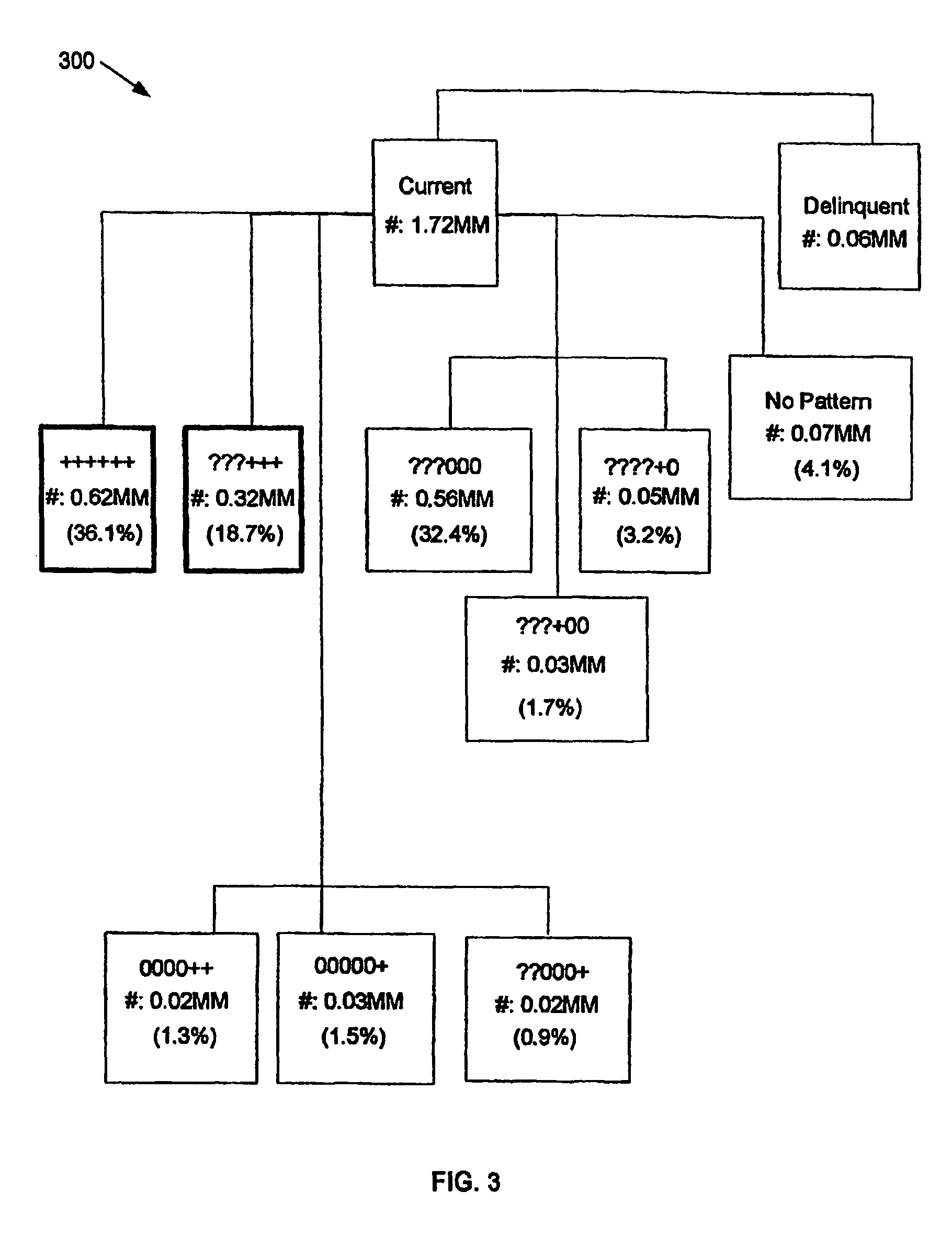

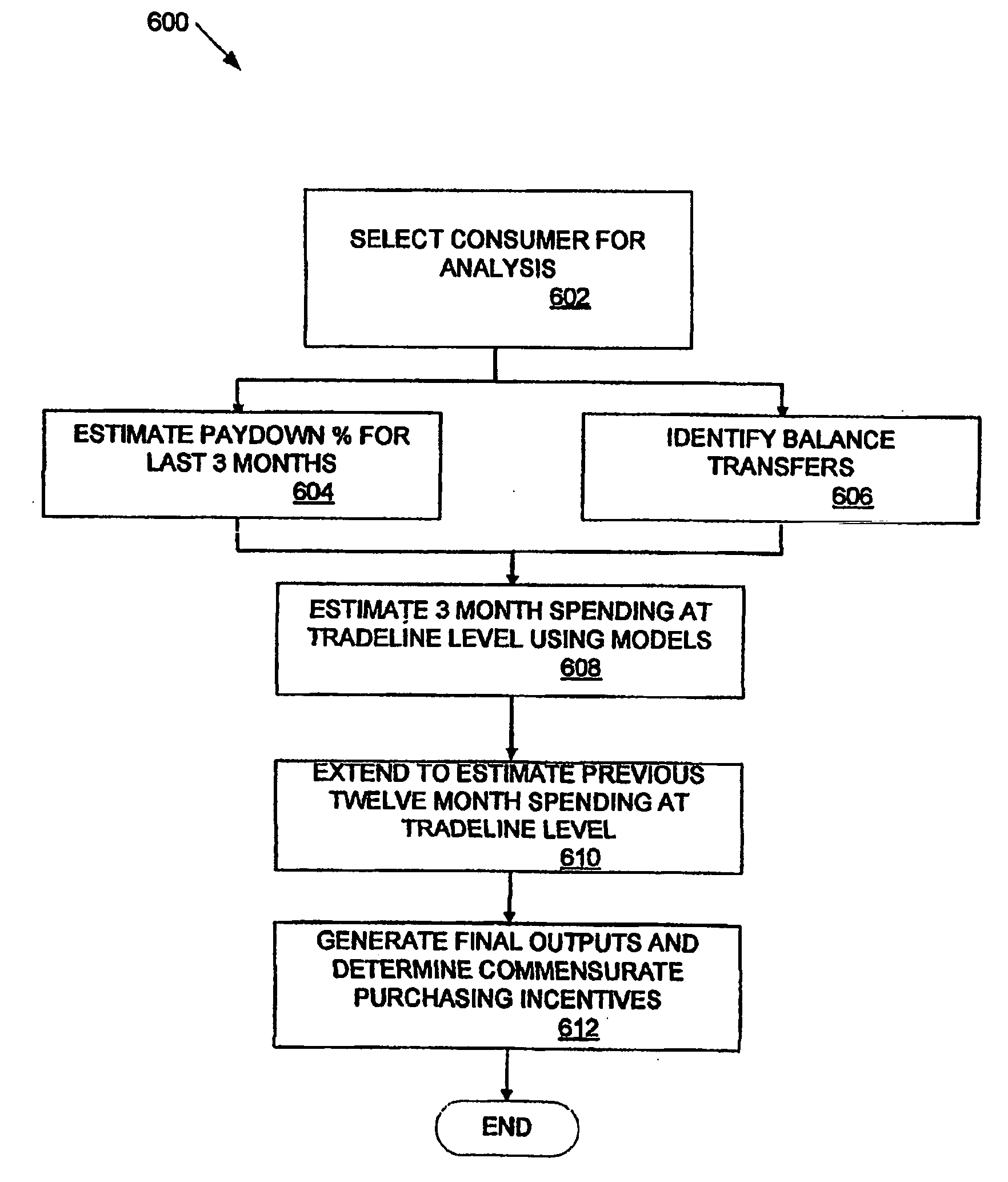

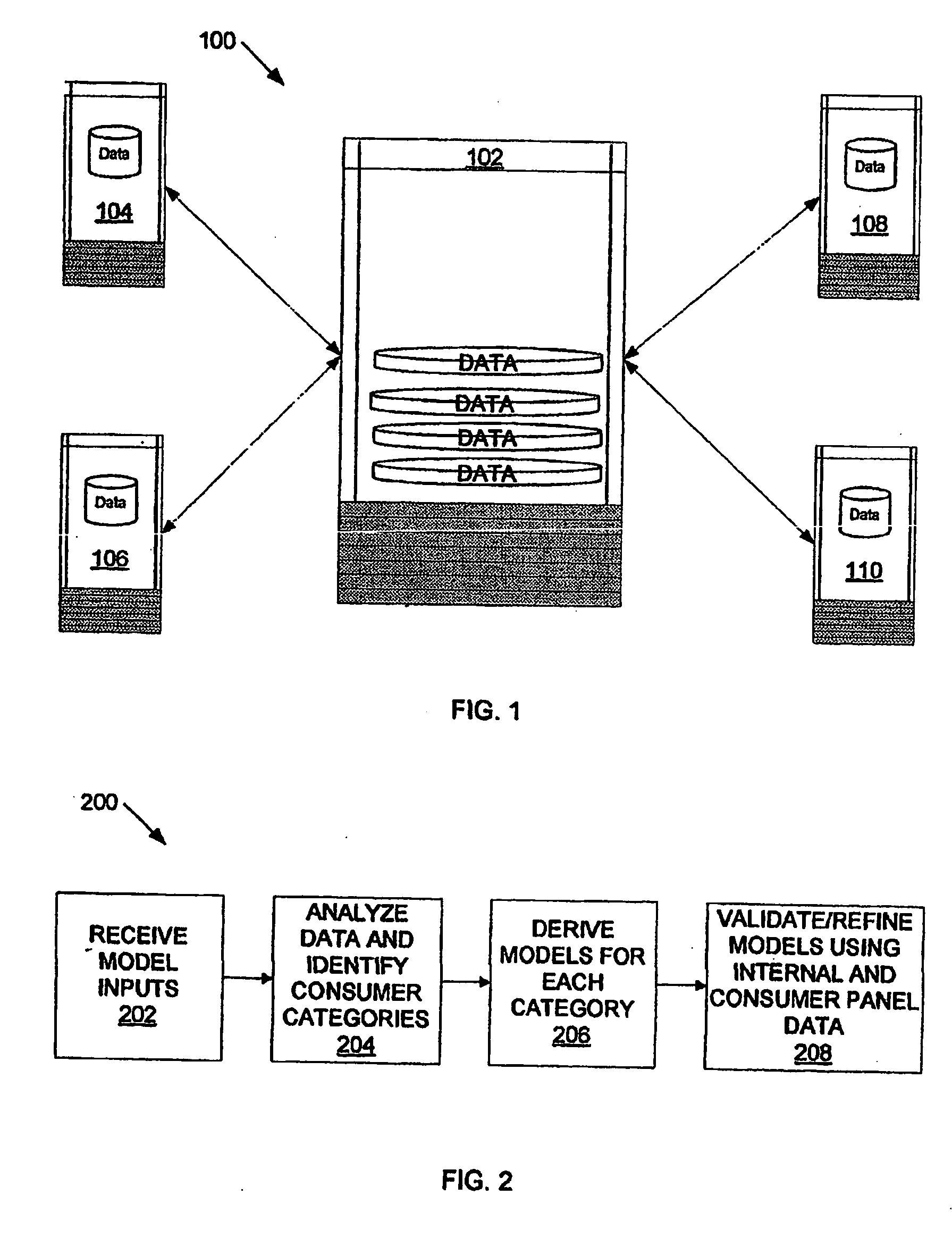

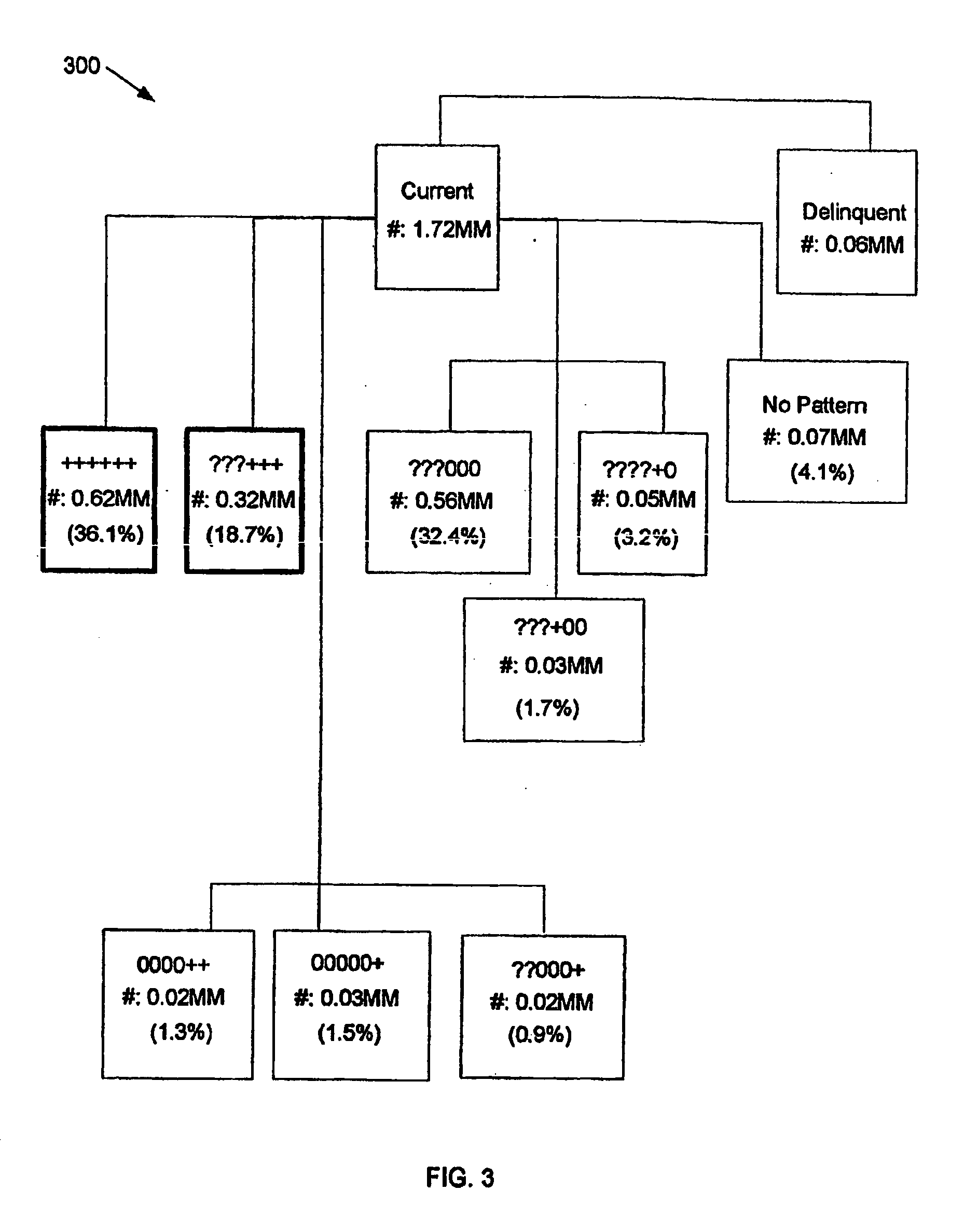

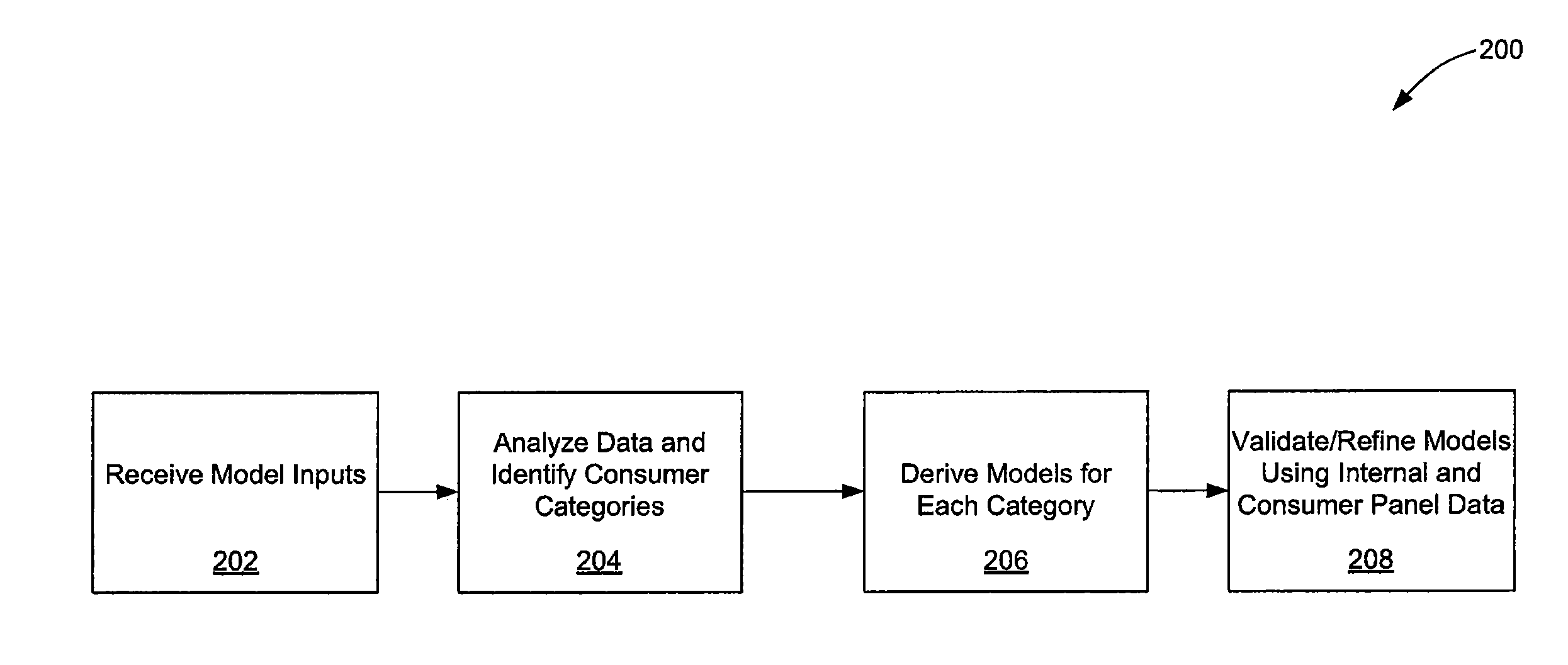

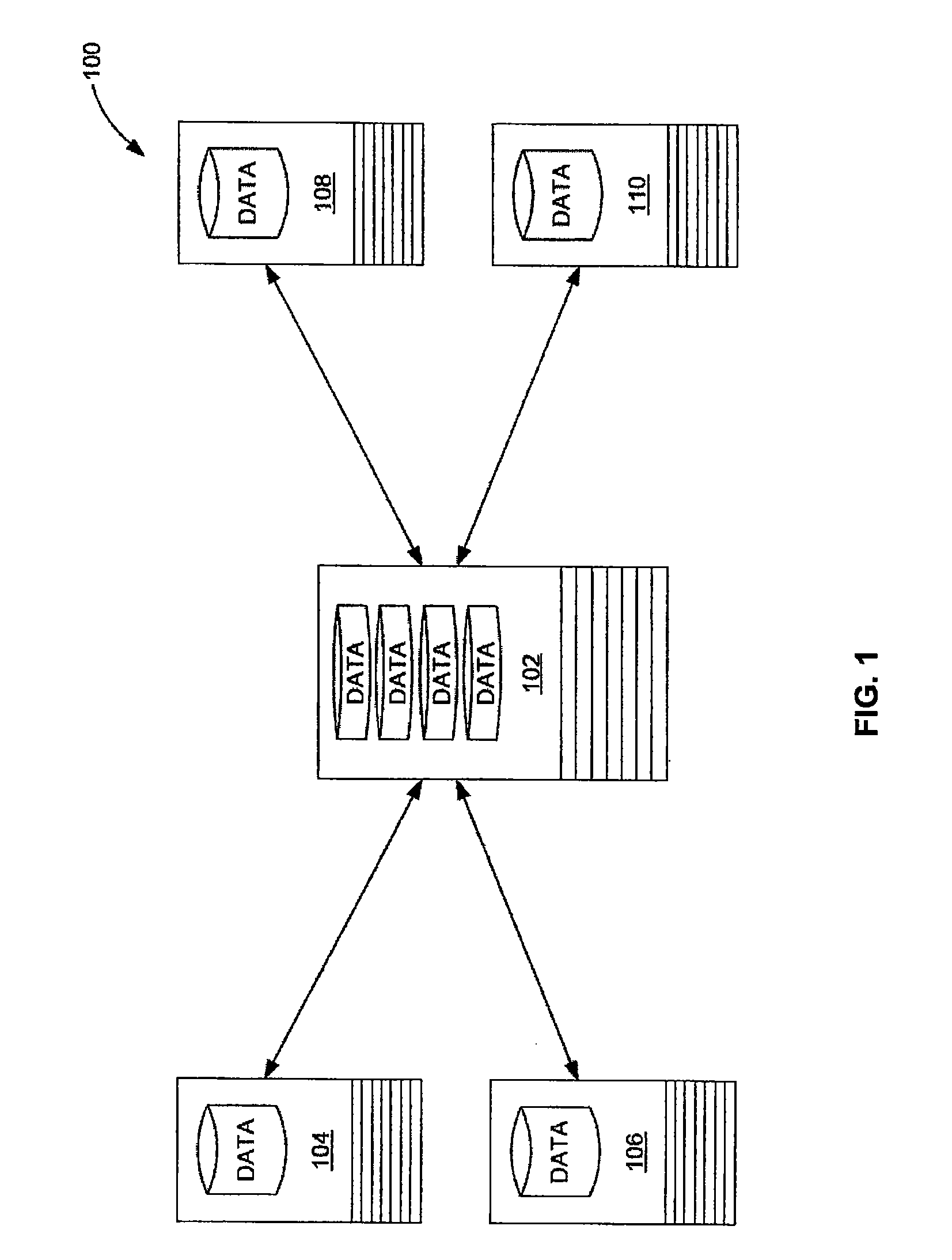

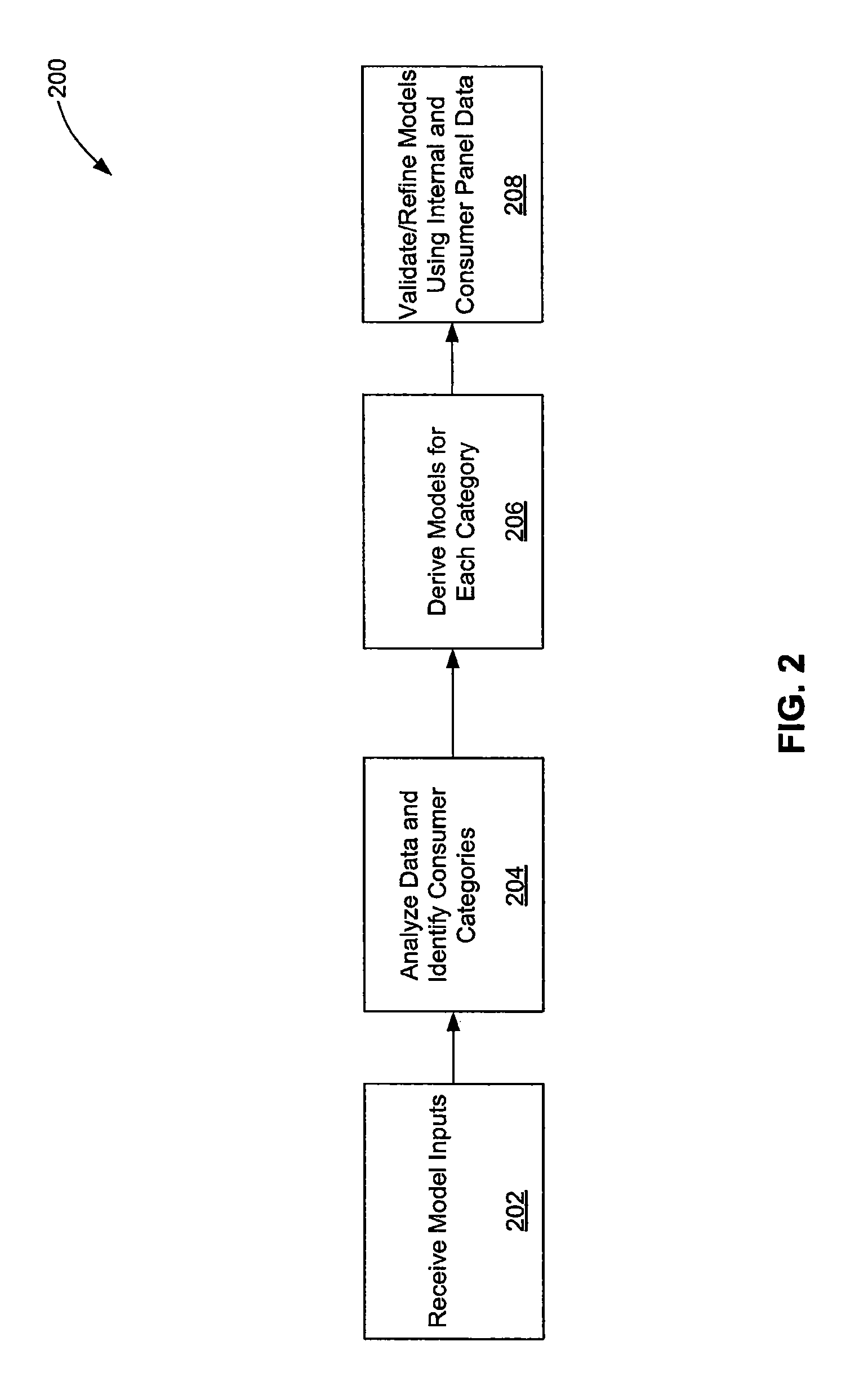

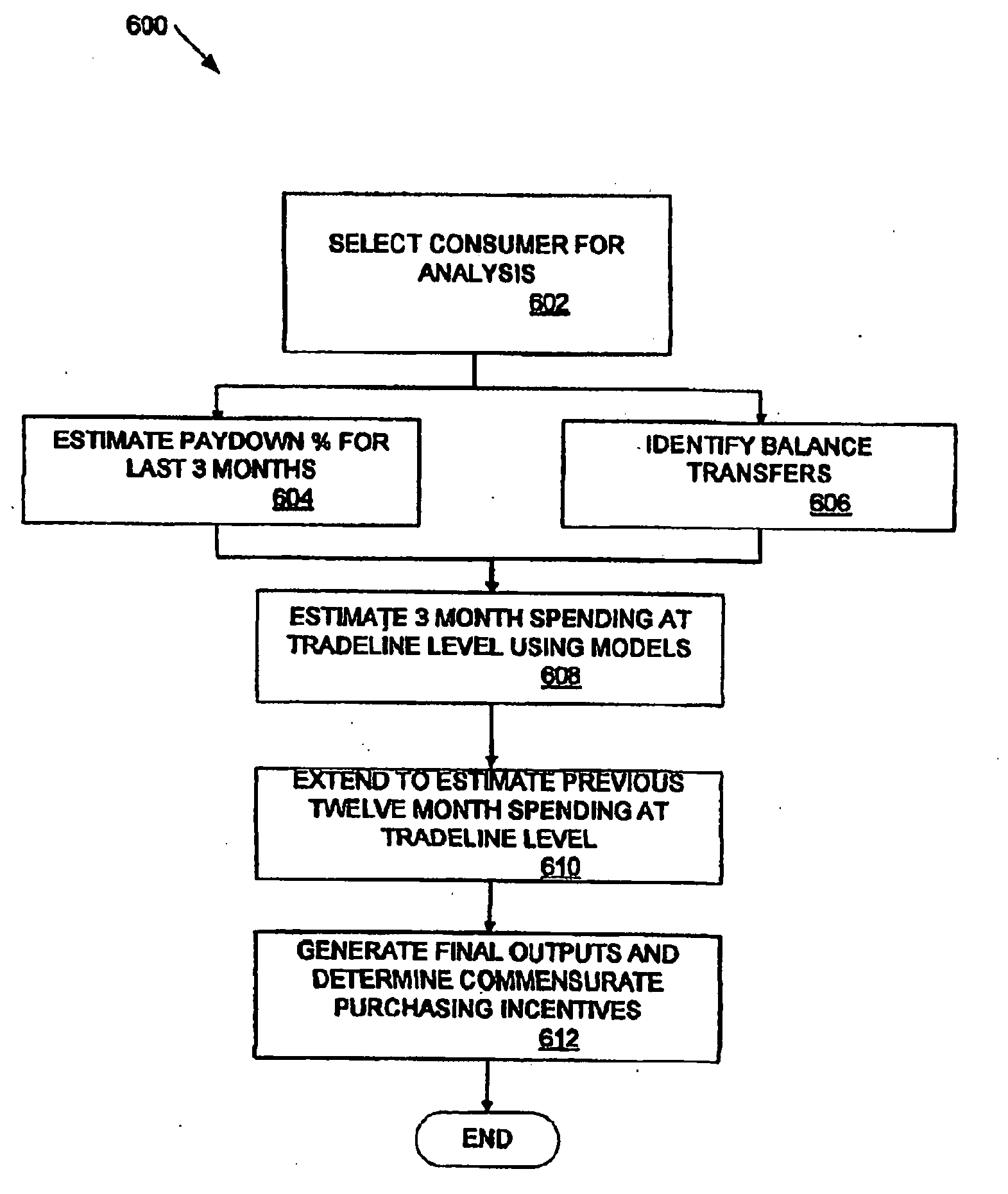

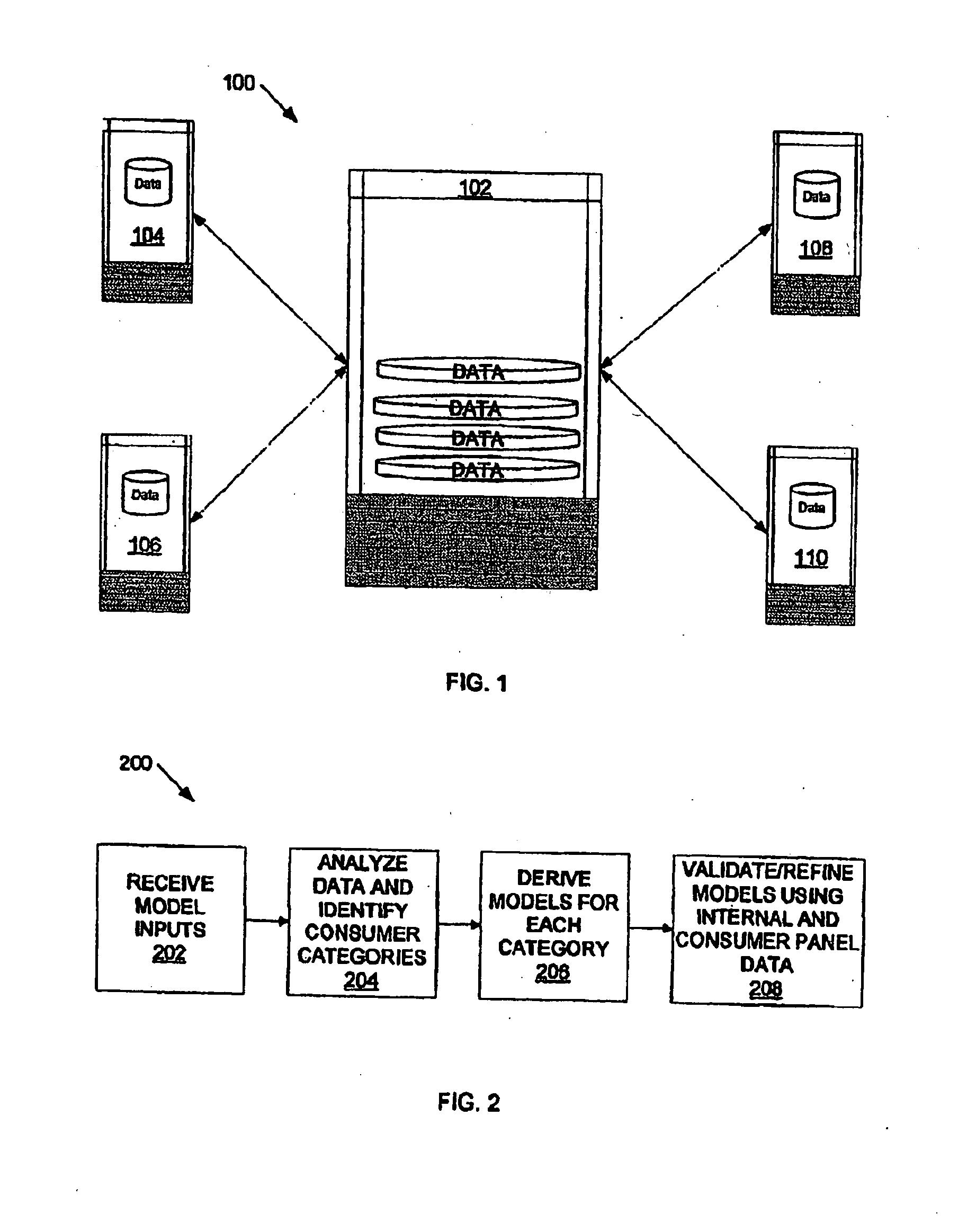

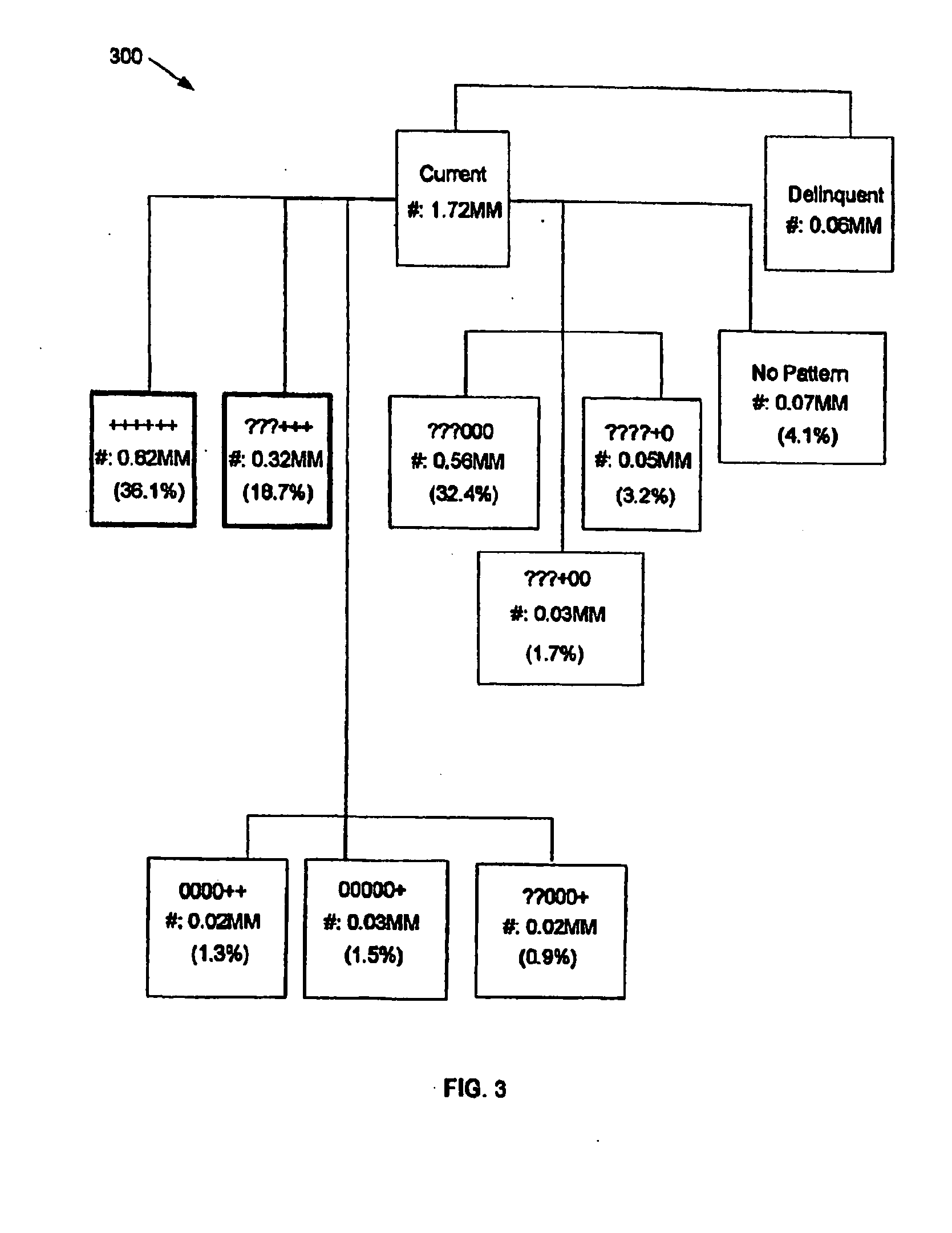

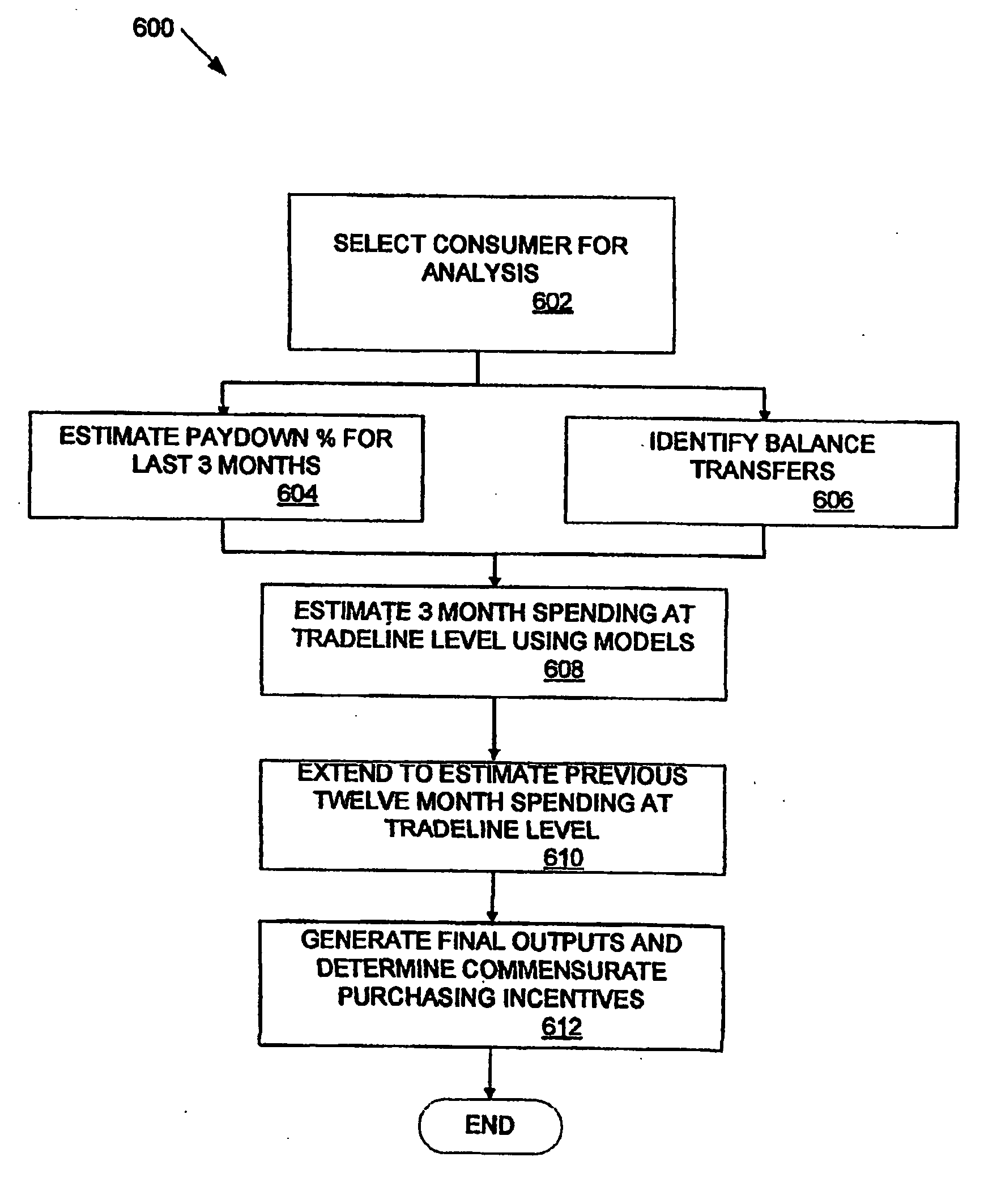

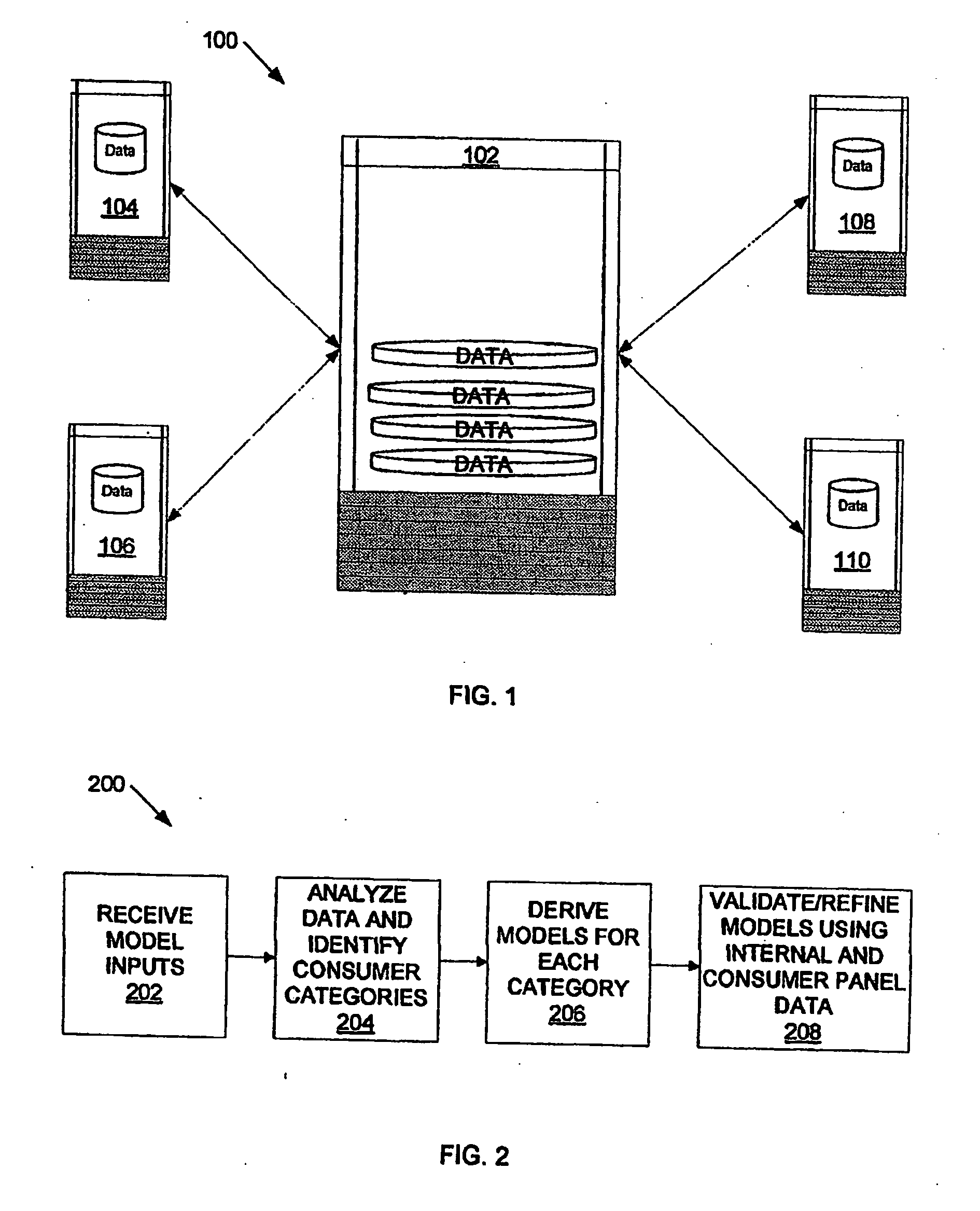

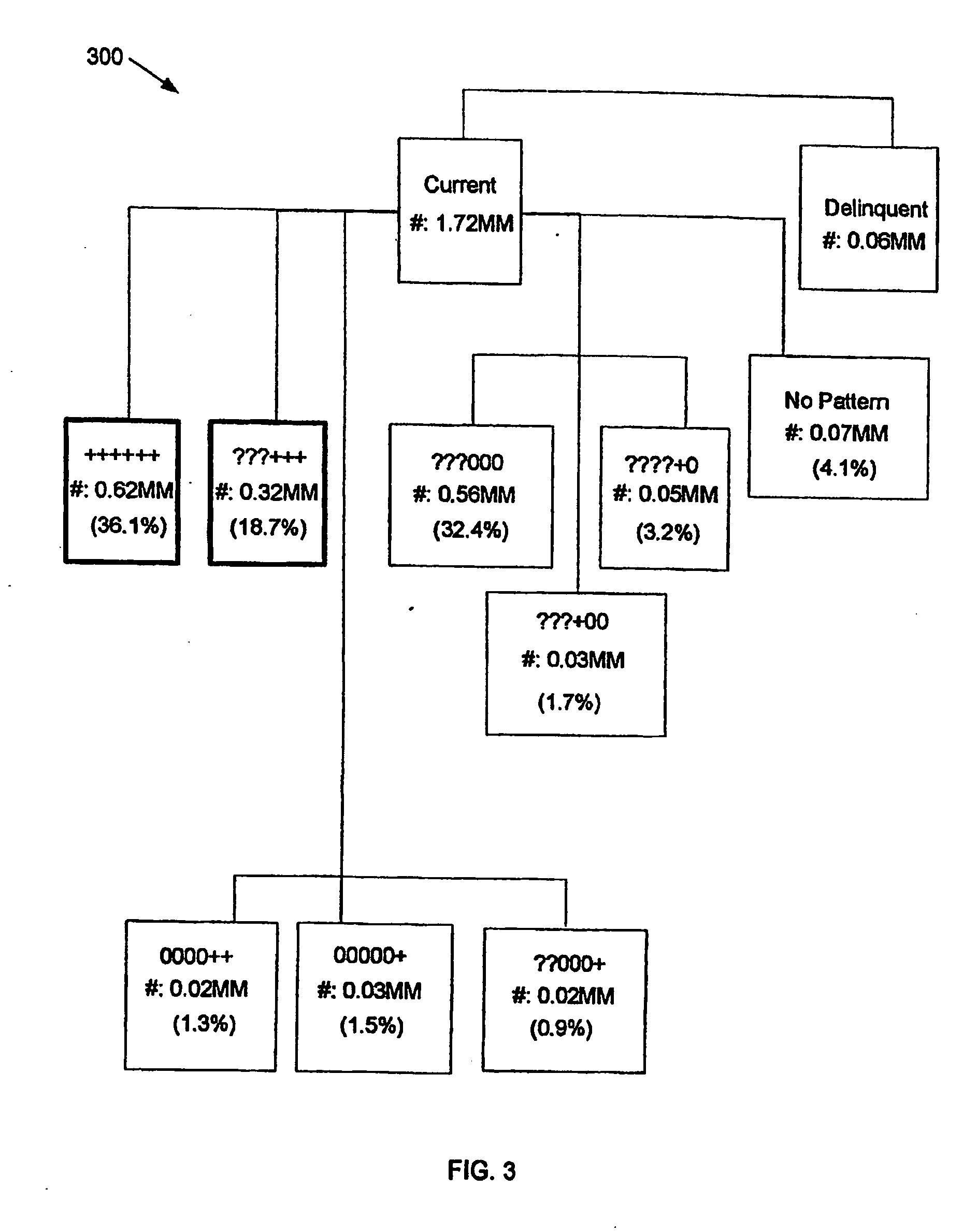

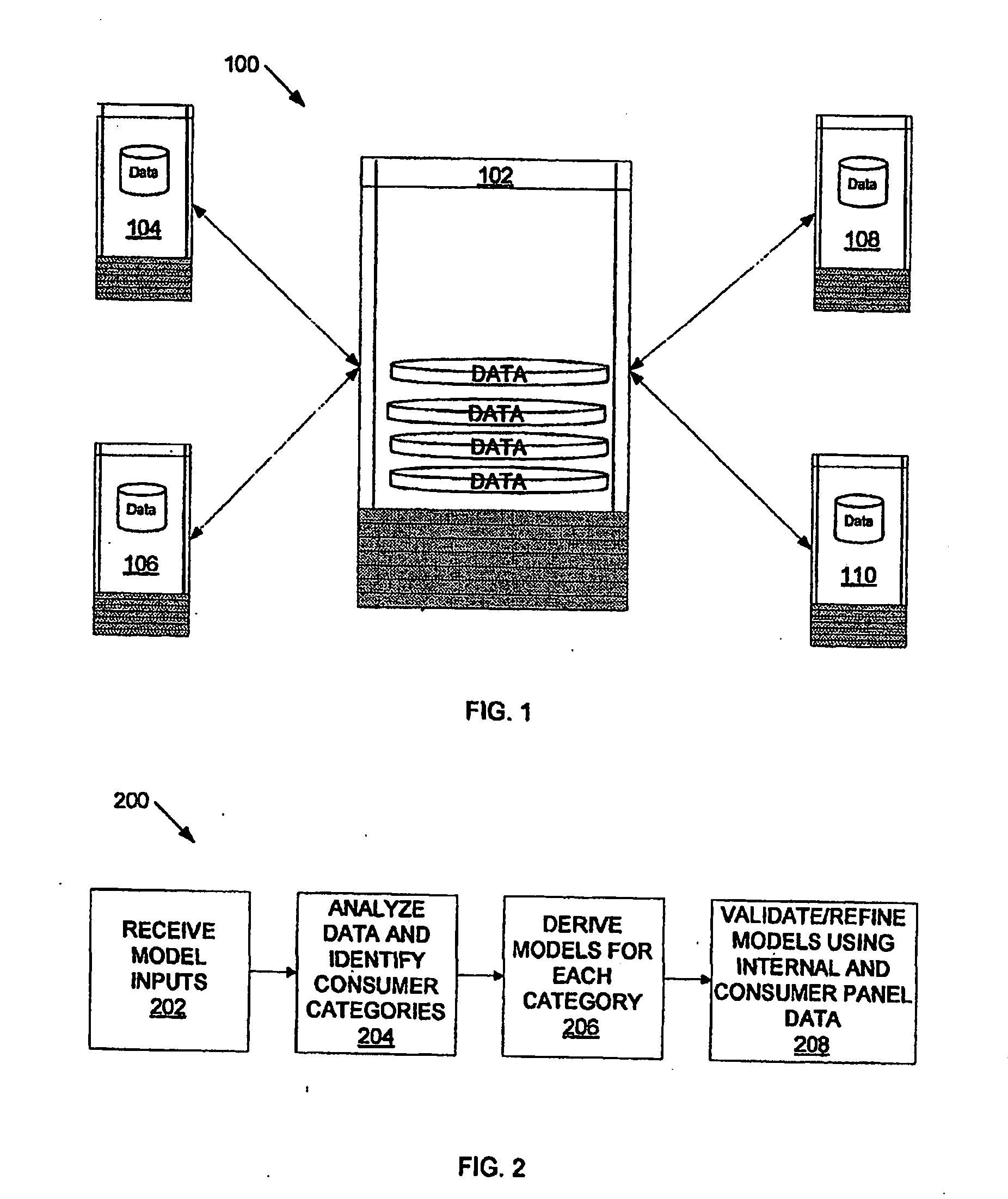

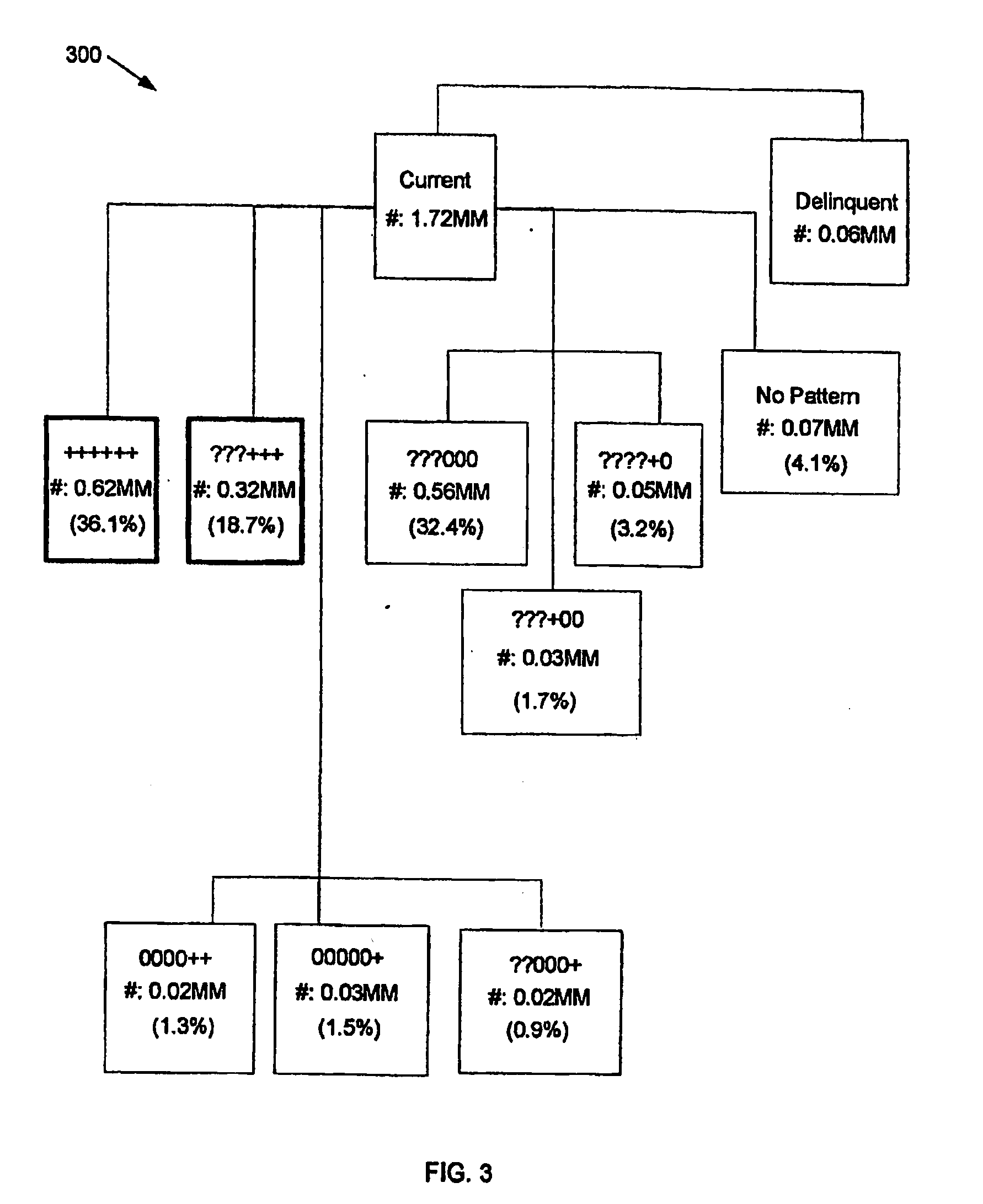

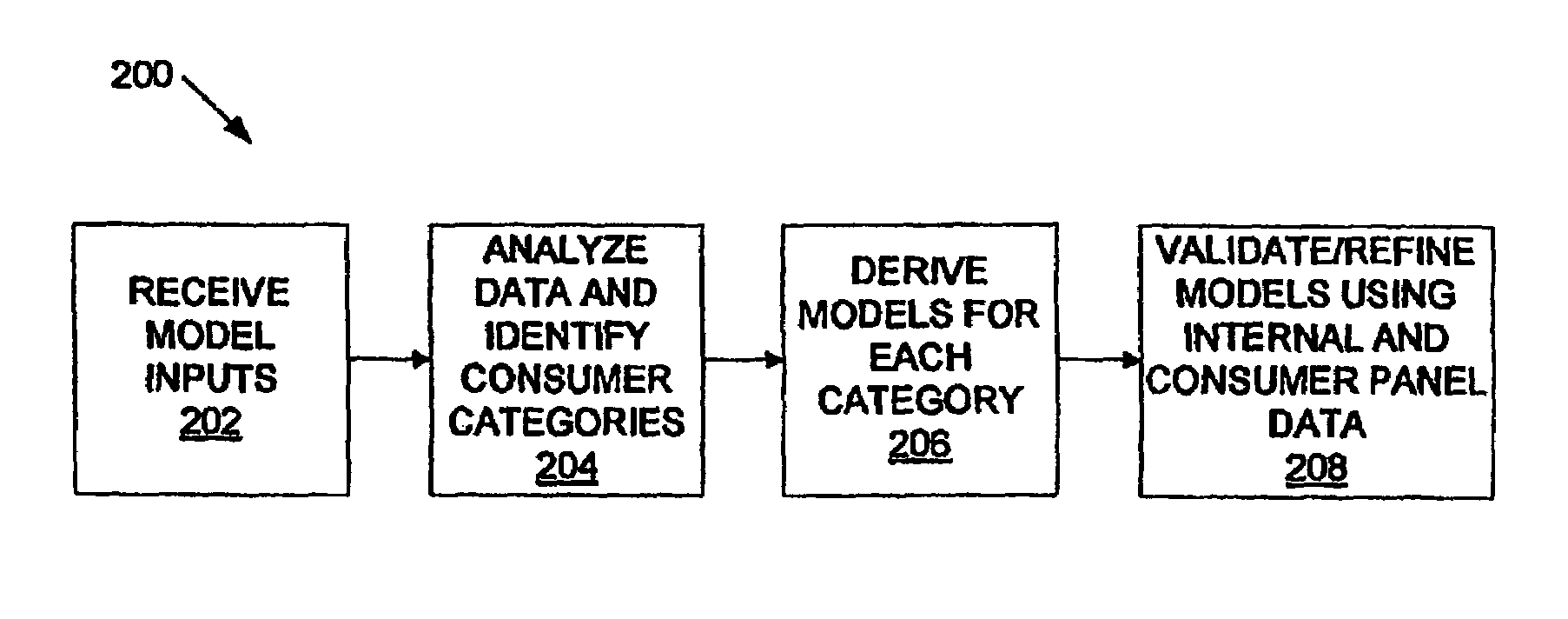

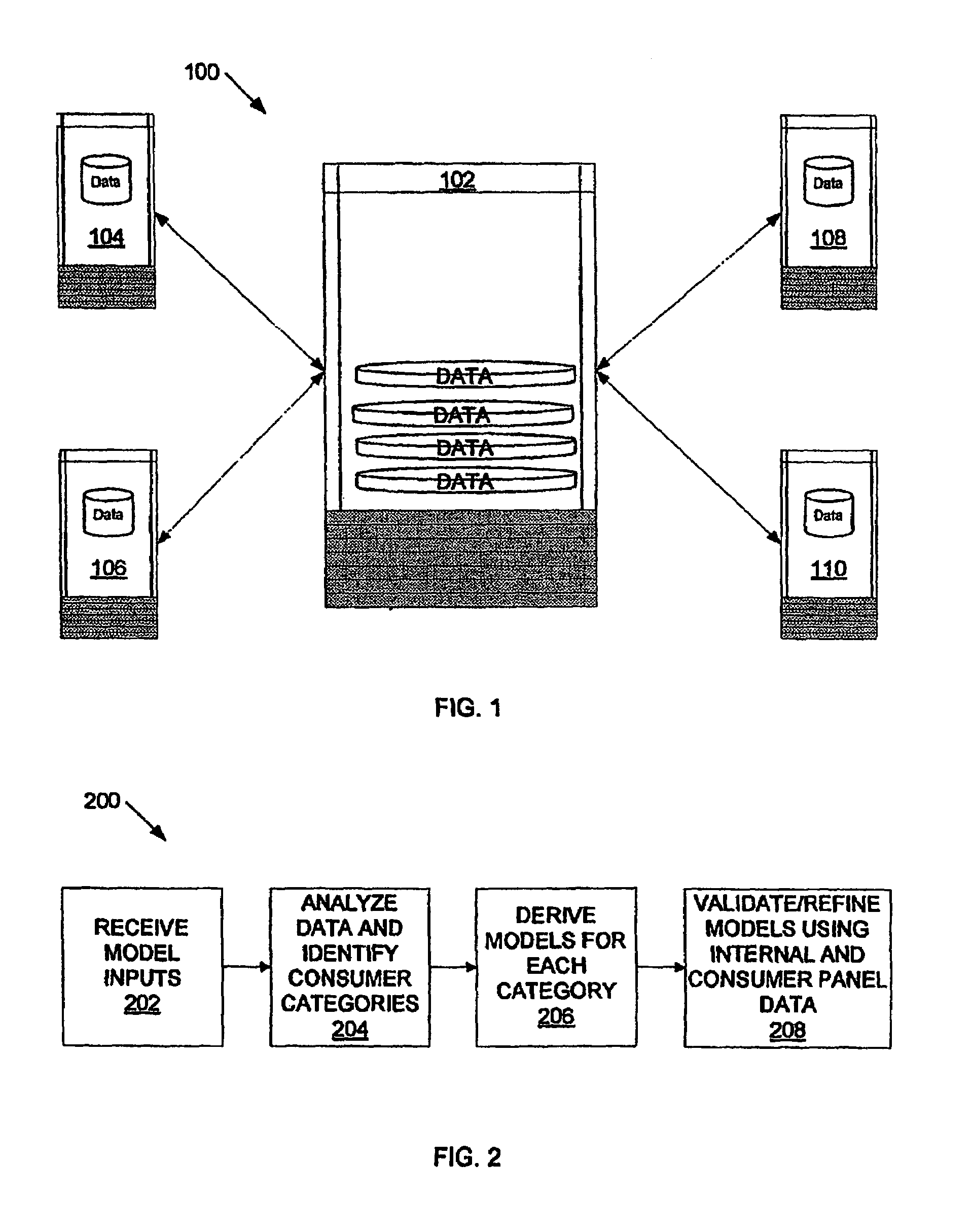

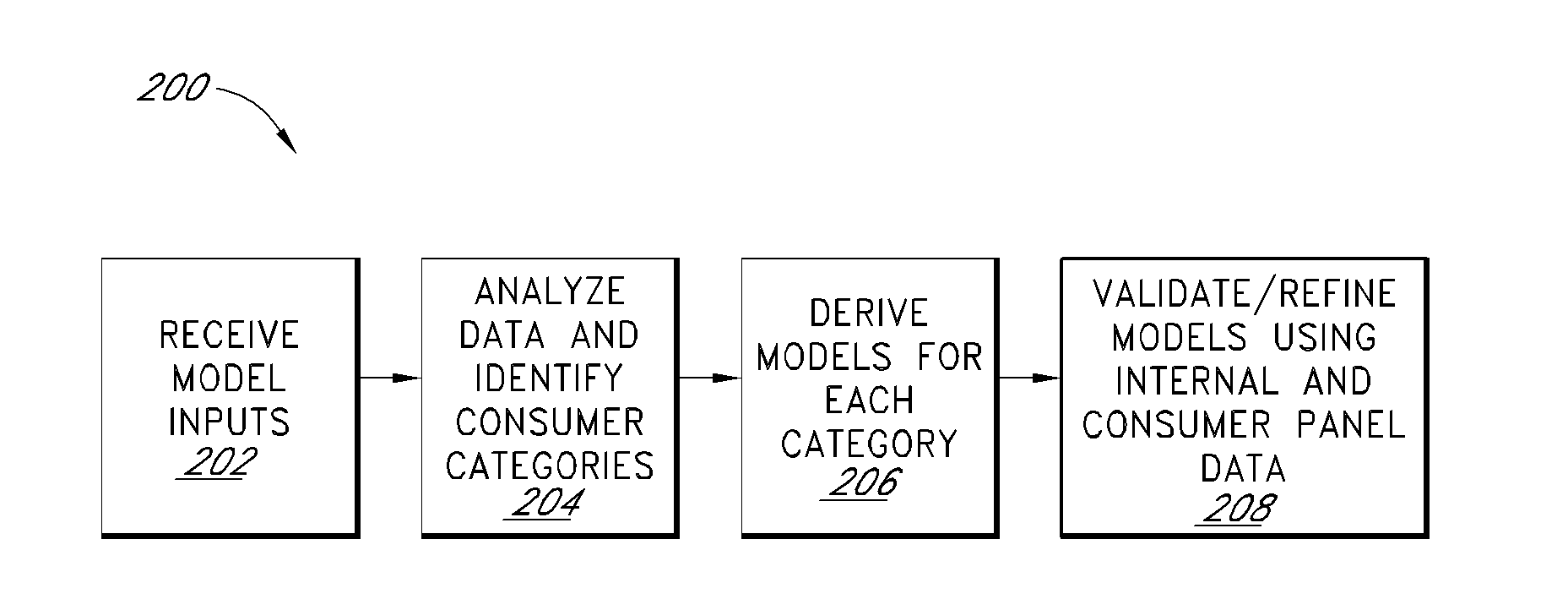

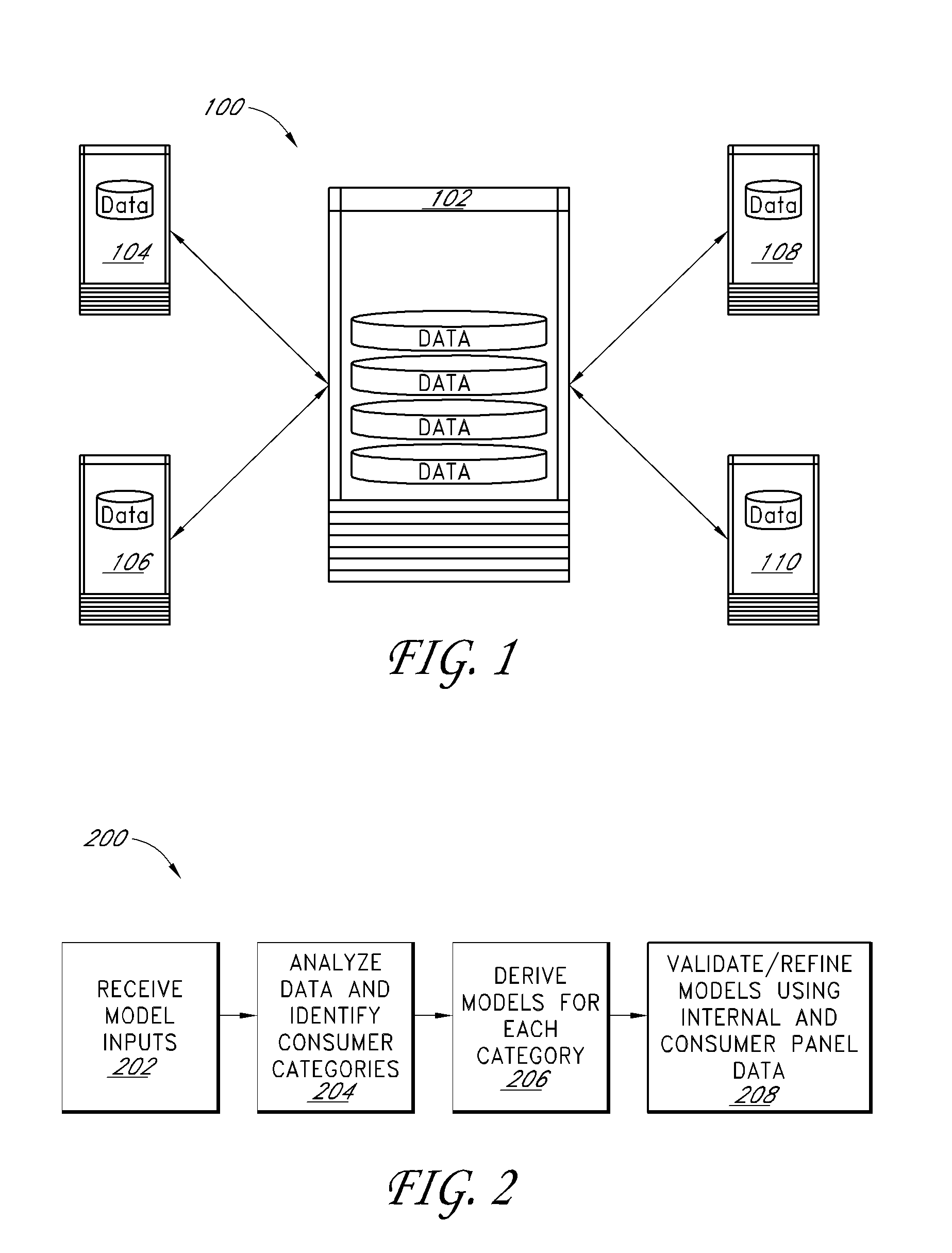

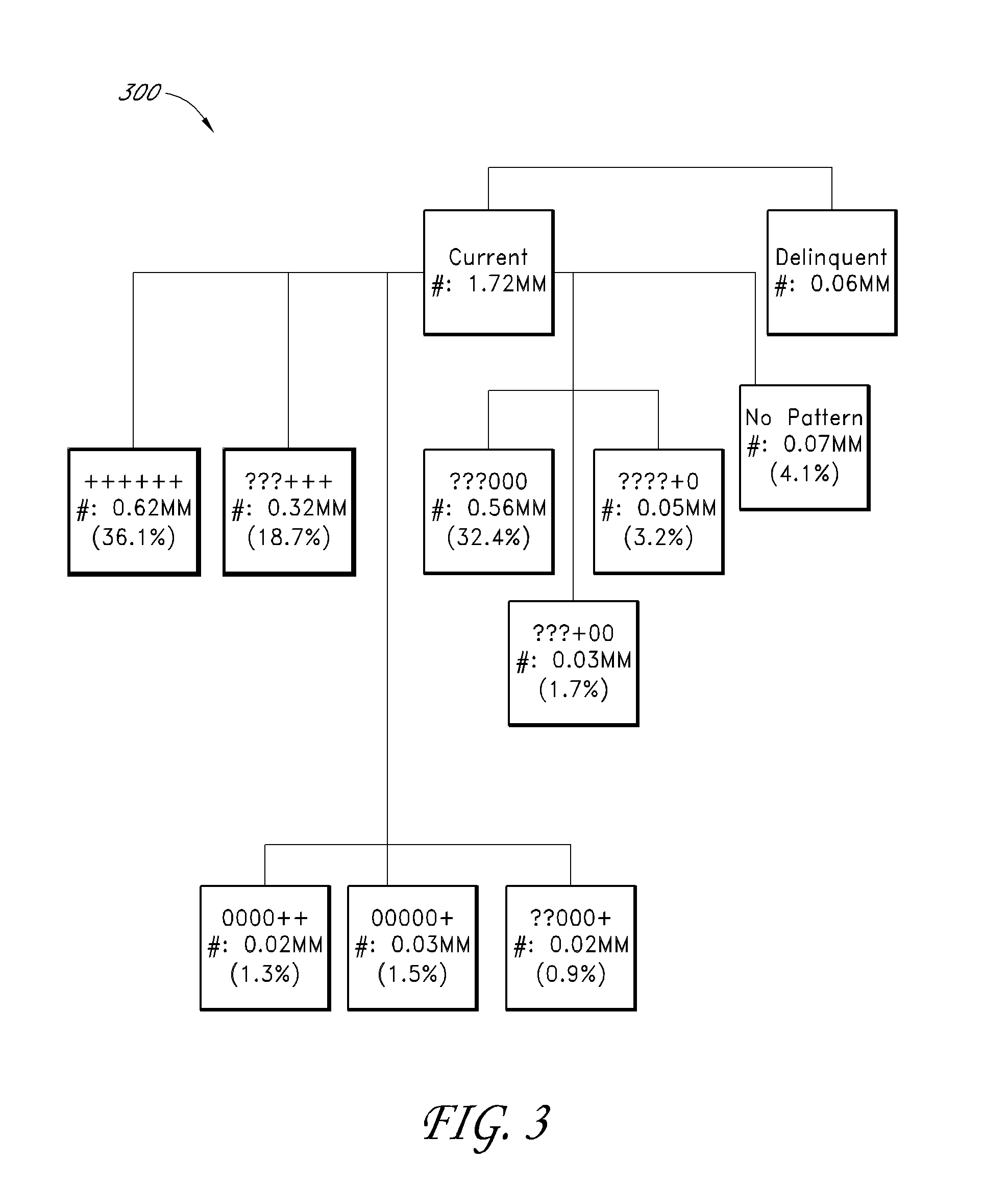

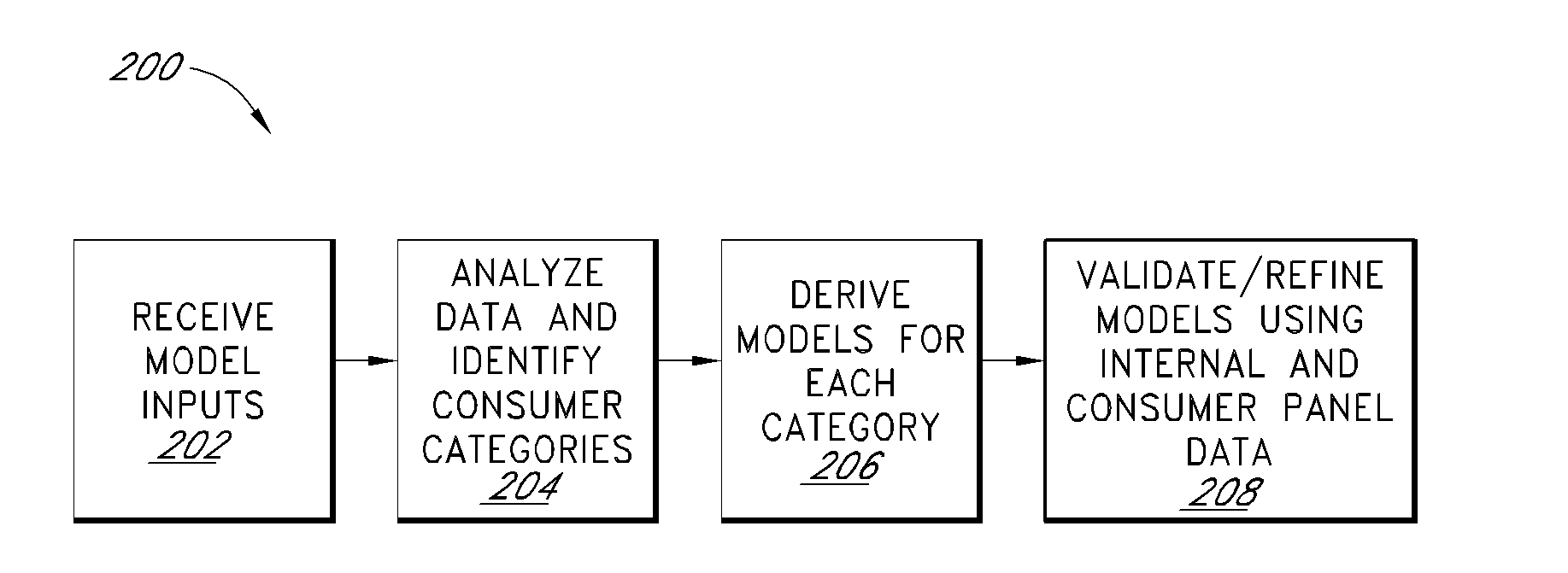

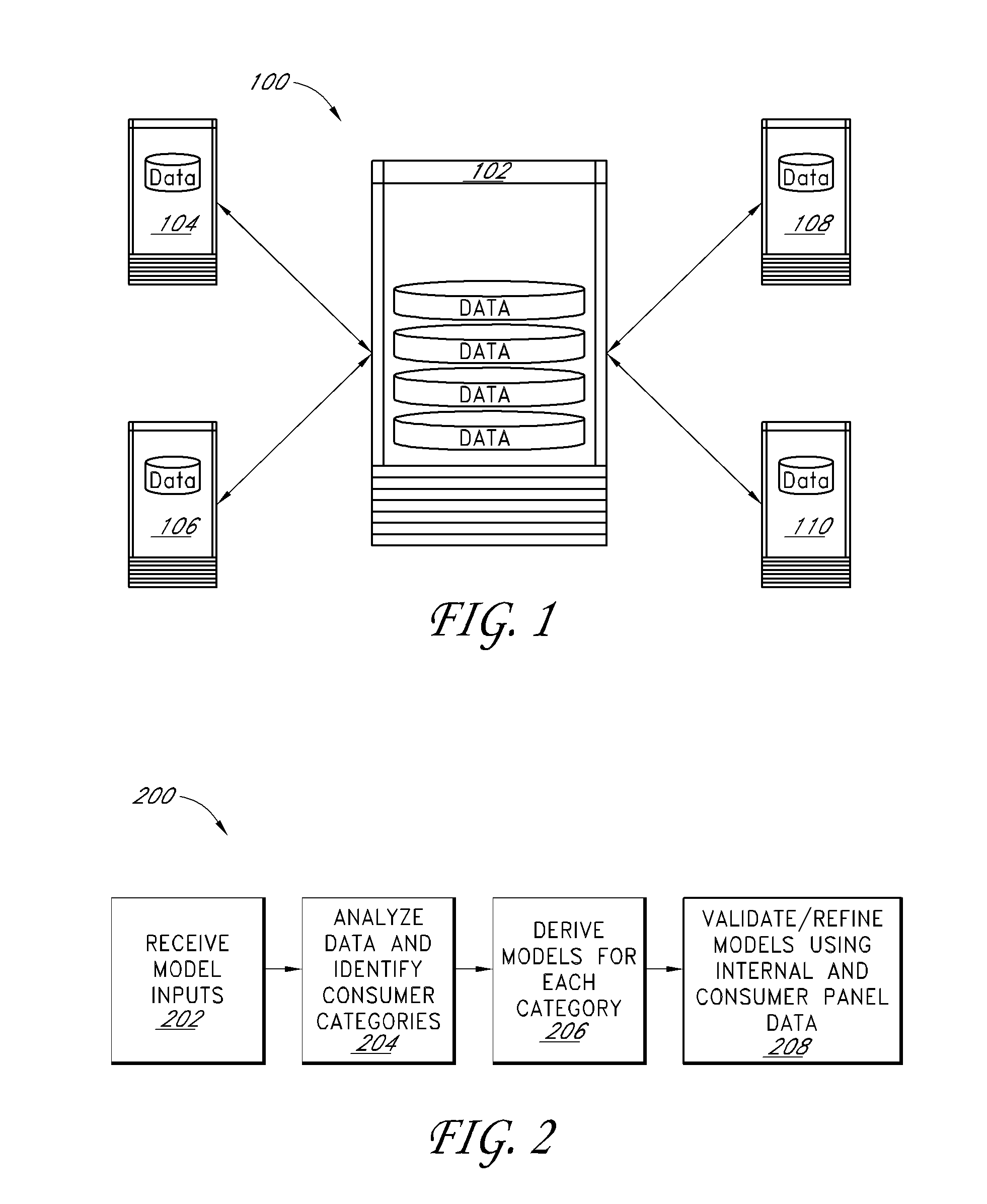

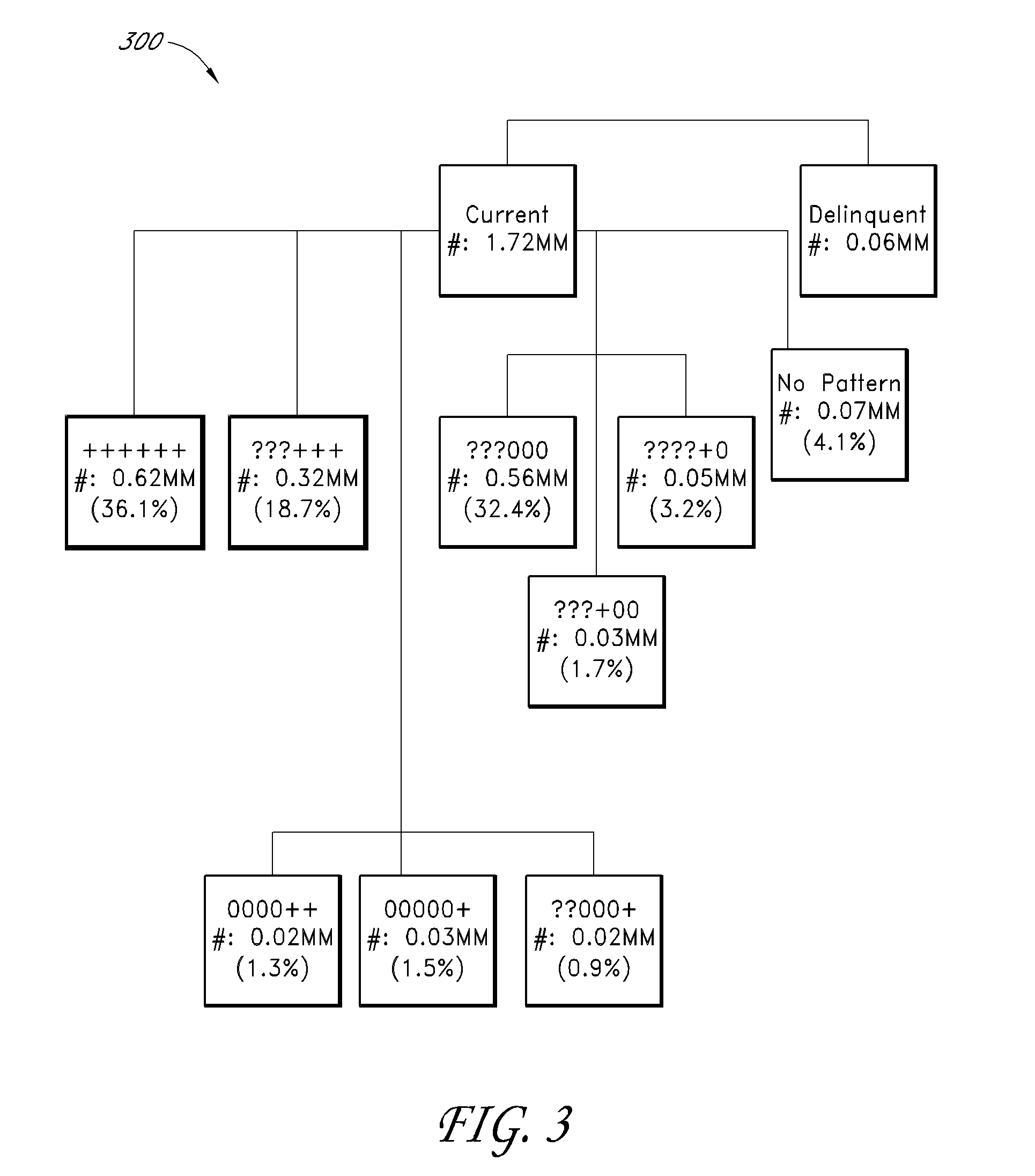

Share of Wallet (“SoW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumer's spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. In addition to credit card companies, SoW outputs may be useful to companies issuing, for example: private label cards, life insurance, on-line brokerages, mutual funds, car sales / leases, hospitals, and home equity lines of credit or loans. “Best customer” models can correlate SoW outputs with various customer groups. A SoW score focusing on a consumer's spending capacity can be used in the same manner as a credit bureau score.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

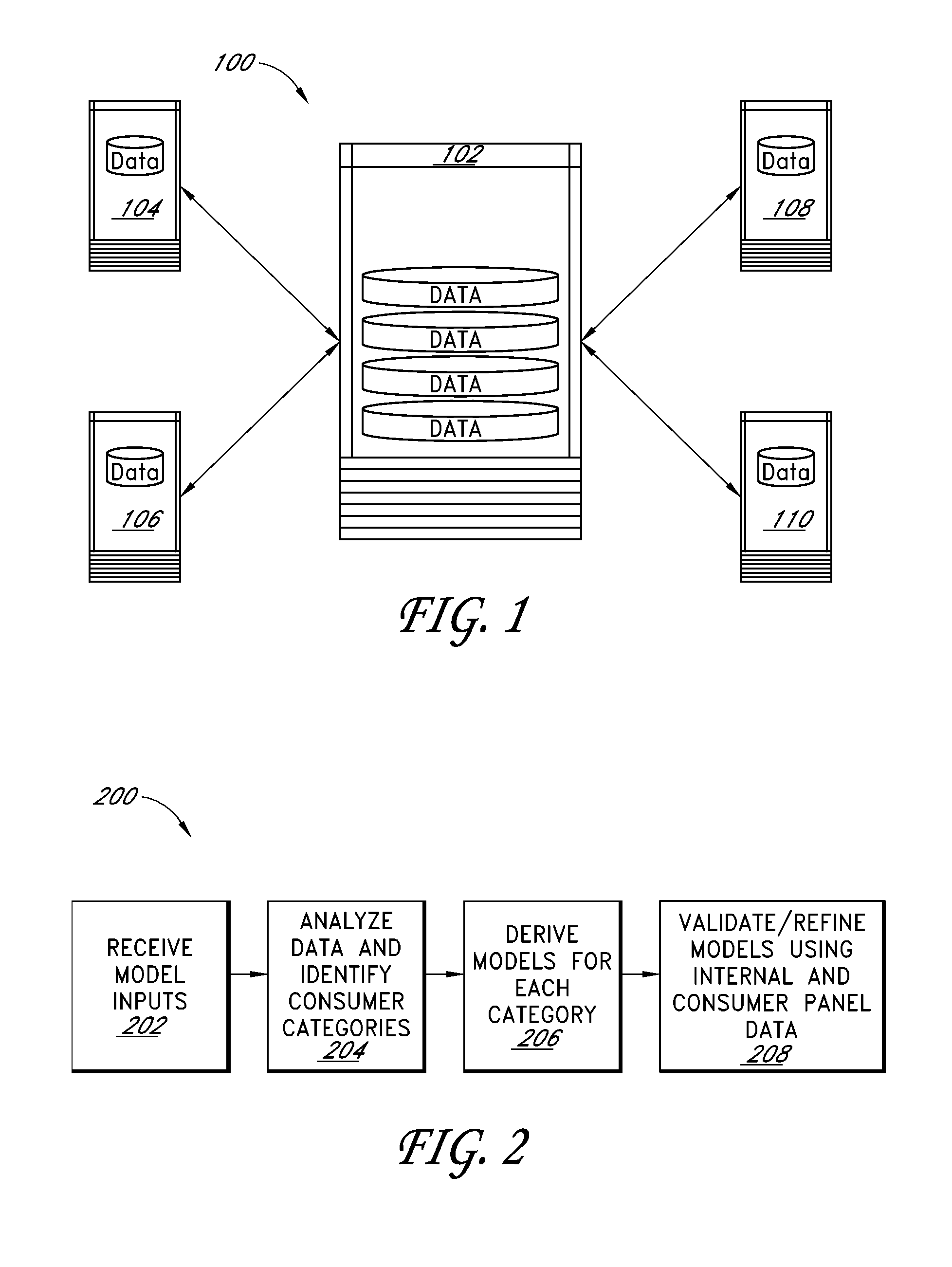

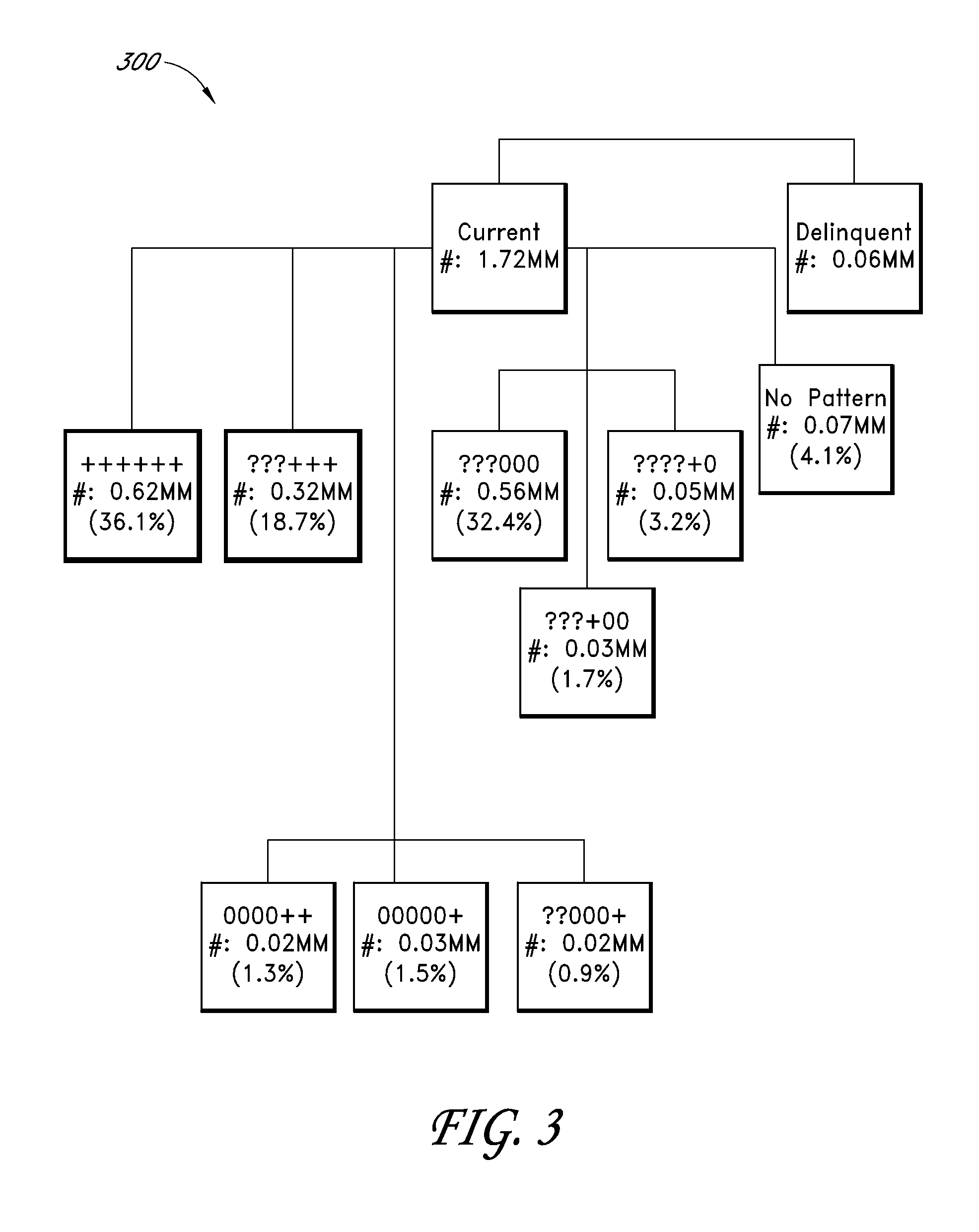

Method and apparatus for determining credit characteristics of a consumer

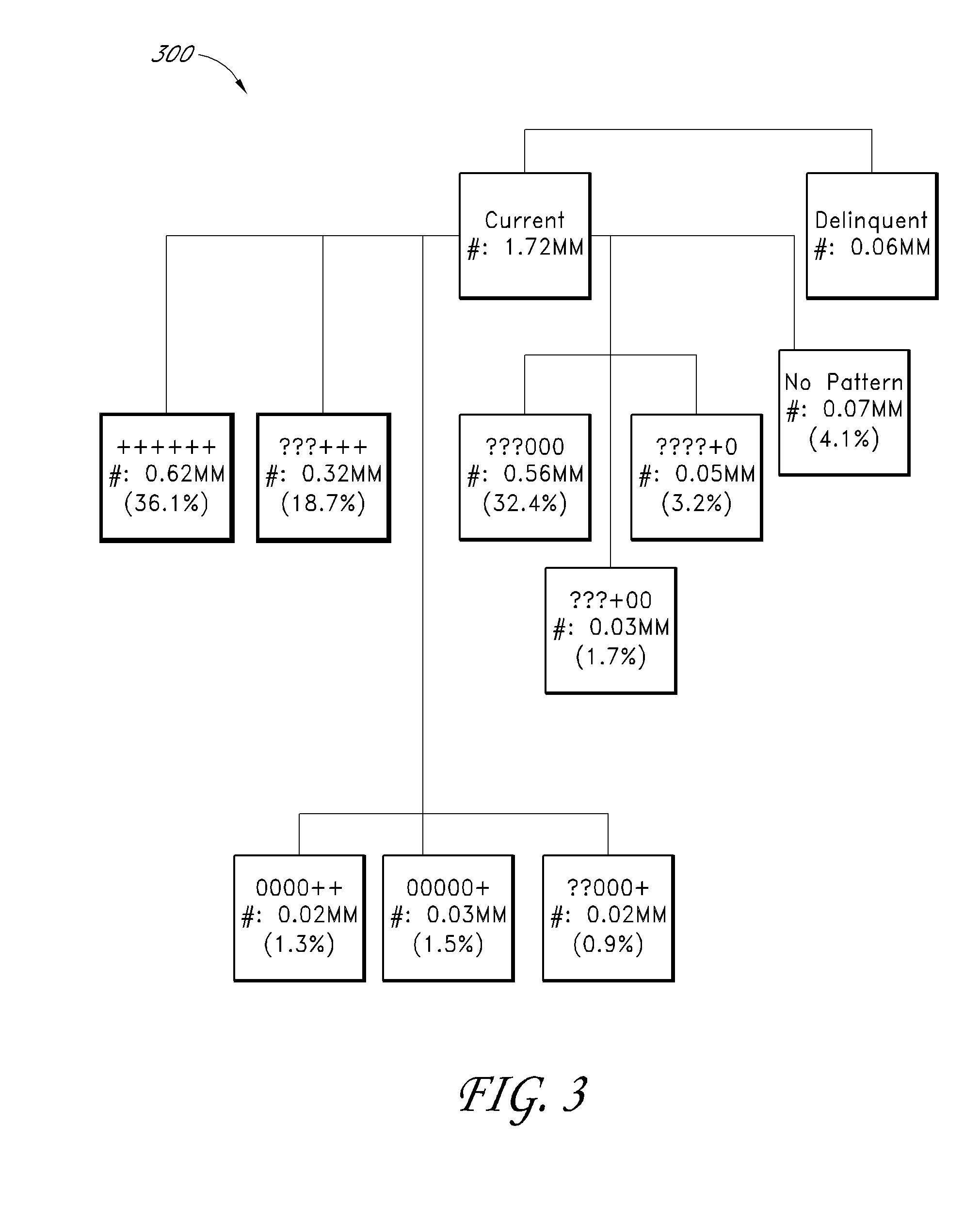

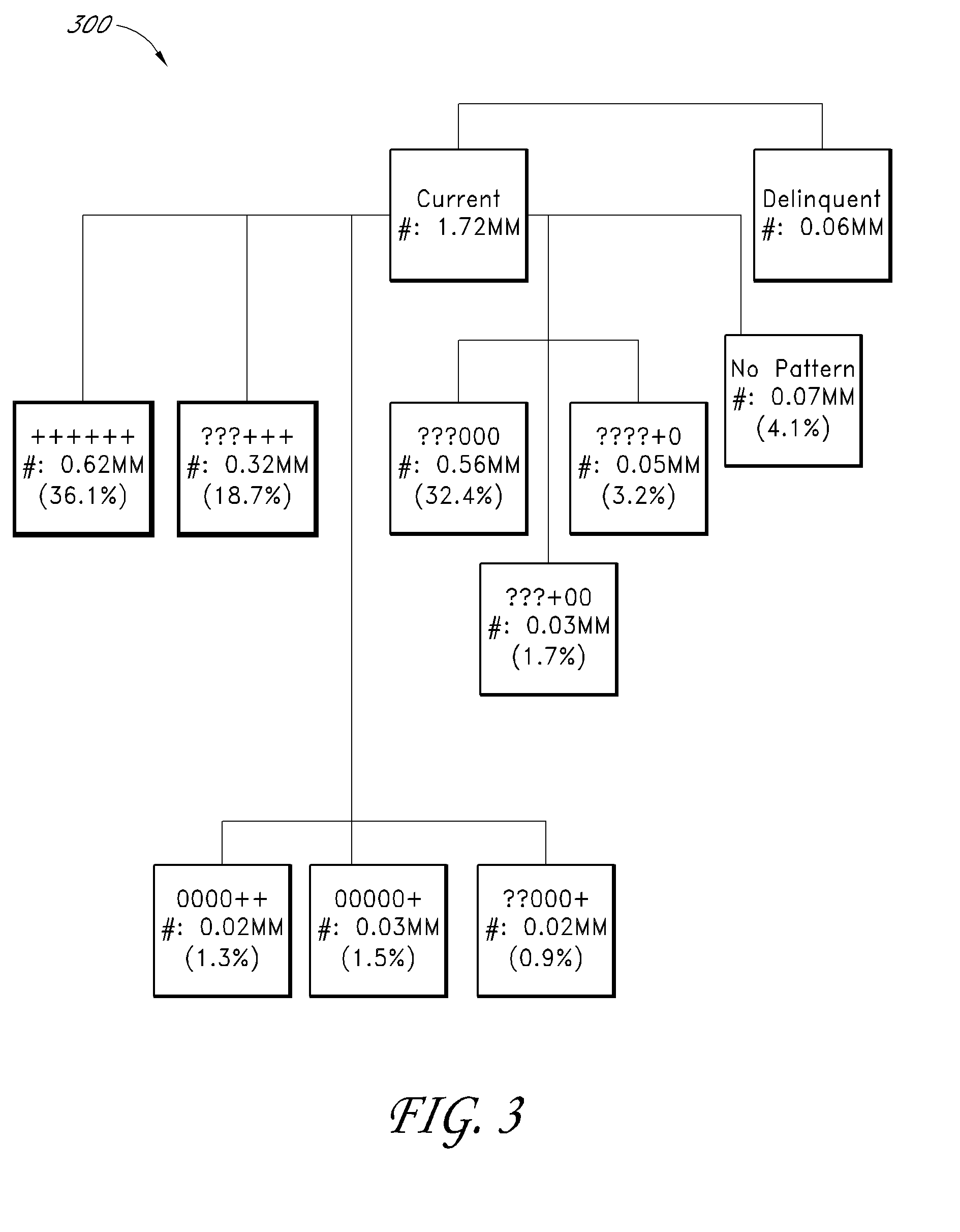

Share of Wallet (“SOW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumers spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. The outputs include the size of the consumer's spending wallet over a particular time period, the total number of the consumer's revolving cards, the consumer's revolving balance, the consumer's average pay-down percentage for revolving cards, total number of the consumer's transacting cards, the consumer's transacting balance, a number of balance transfers transacted by the consumer, the total amount of the consumer's balance transfers, the consumer's maximum revolving balance, the consumer's maximum transacting balance, the consumer's credit limit, size of the consumer's revolving spending, and the size of the consumer's transacting spending.

Owner:EXPERIAN MARKETING SOLUTIONS

Credit score and scorecard development

InactiveUS20080222027A1Efficient use ofEfficient managementFinanceCommerceBalance transferData source

Share of Wallet (“SOW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumers spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. The outputs can be used as attributes to consider in developing a credit bureau scorecard.

Owner:EXPERIAN MARKETING SOLUTIONS

Method and apparatus for consumer interaction based on spend capacity

InactiveUS20080228556A1Efficient use ofEfficient managementFinanceSpecial data processing applicationsBalance transferInsurance life

Owner:EXPERIAN MARKETING SOLUTIONS

Method and apparatus for targeting best customers based on spend capacity

Share of Wallet (“SOW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumers spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. “Best customer” models can correlate SOW outputs with various customer groups for targeted marketing.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

Method and apparatus for rating asset-backed securities

ActiveUS20060242047A1Efficient use ofEfficient managementFinanceInput/output processes for data processingBalance transferData source

Share of Wallet (“SOW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumer's spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. The likelihood of default determined by the SOW model, when applied to a loan portfolio, can reduce the amount of credit enhancement required for an asset-backed securities rating.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

Method and apparatus for rating asset-backed securities

Share of Wallet (“SOW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumer's spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. The likelihood of default determined by the SOW model, when applied to a loan portfolio, can reduce the amount of credit enhancement required for an asset-backed securities rating.

Owner:EXPERIAN MARKETING SOLUTIONS

Credit score and scorecard development

ActiveUS7840484B2Efficient use ofEfficient managementFinancePayment architectureBalance transferData source

Share of Wallet (“SOW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumers spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. The outputs can be used as attributes to consider in developing a credit bureau scorecard.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

Method and apparatus for development and use of a credit score based on spend capacity

ActiveUS20060242051A1Efficient use ofEfficient managementMarket predictionsFinanceBalance transferData source

Share of Wallet (“SOW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumers spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. A SOW score focusing on a consumer's spending capability can be used in the same manner as a credit bureau score.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

Reducing Risks Related to Check Verification

ActiveUS20070168246A1Efficient use ofEfficient managementFinanceCash registersBalance transferLower risk

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

Method and apparatus for targeting best customers based on spend capacity

InactiveUS20080221970A1Efficient use ofEfficient managementMarket predictionsFinanceBalance transferData source

Share of Wallet (“SOW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumers spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. “Best customer” models can correlate SOW outputs with various customer groups for targeted marketing.

Owner:EXPERIAN MARKETING SOLUTIONS

Method and apparatus for determining credit characteristics of a consumer

Share of Wallet (“SOW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumers spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. The outputs include the size of the consumer's spending wallet over a particular time period, the total number of the consumer's revolving cards, the consumer's revolving balance, the consumer's average pay-down percentage for revolving cards, total number of the consumer's transacting cards, the consumer's transacting balance, a number of balance transfers transacted by the consumer, the total amount of the consumer's balance transfers, the consumer's maximum revolving balance, the consumer's maximum transacting balance, the consumer's credit limit, size of the consumer's revolving spending, and the size of the consumer's transacting spending.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

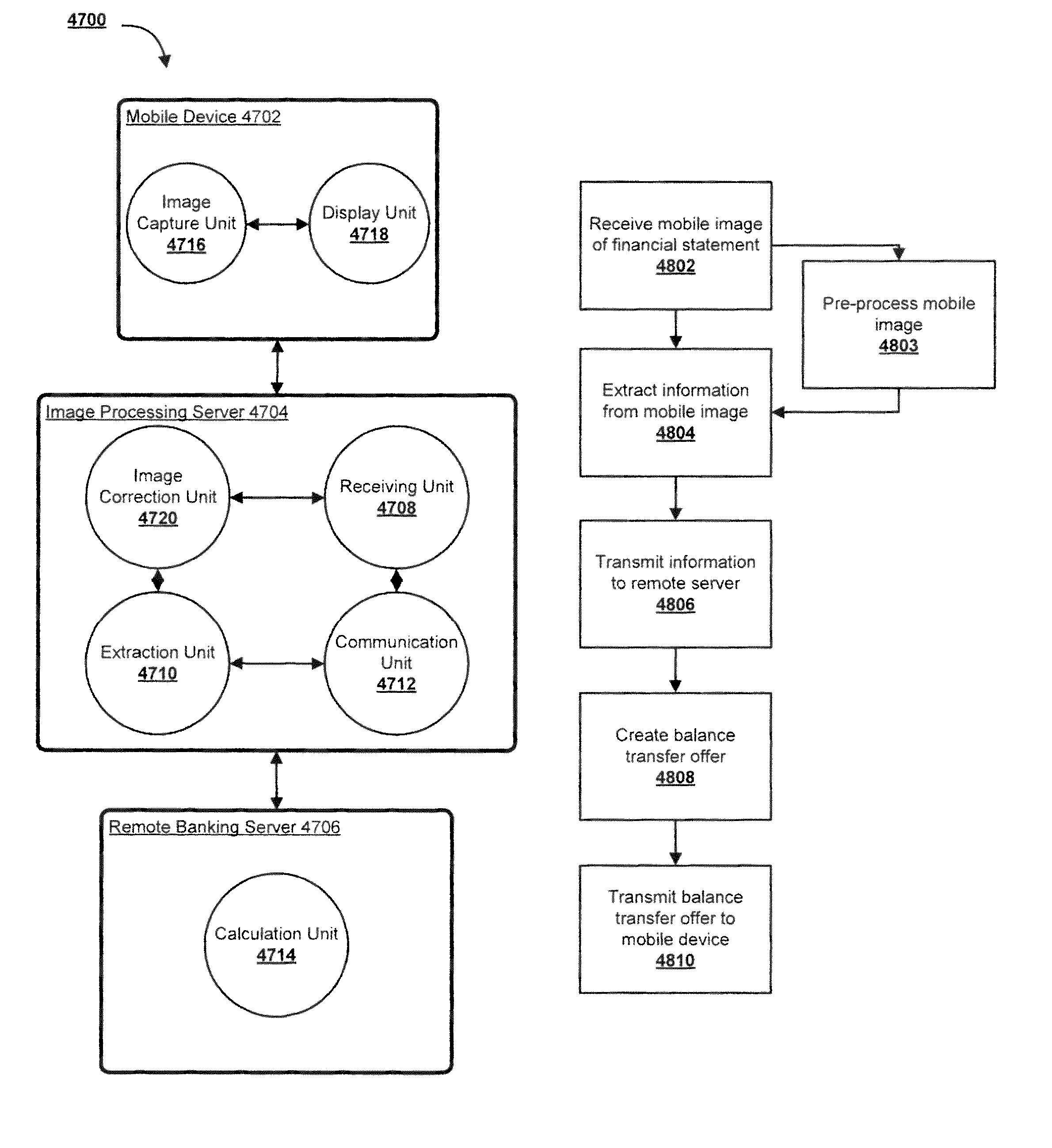

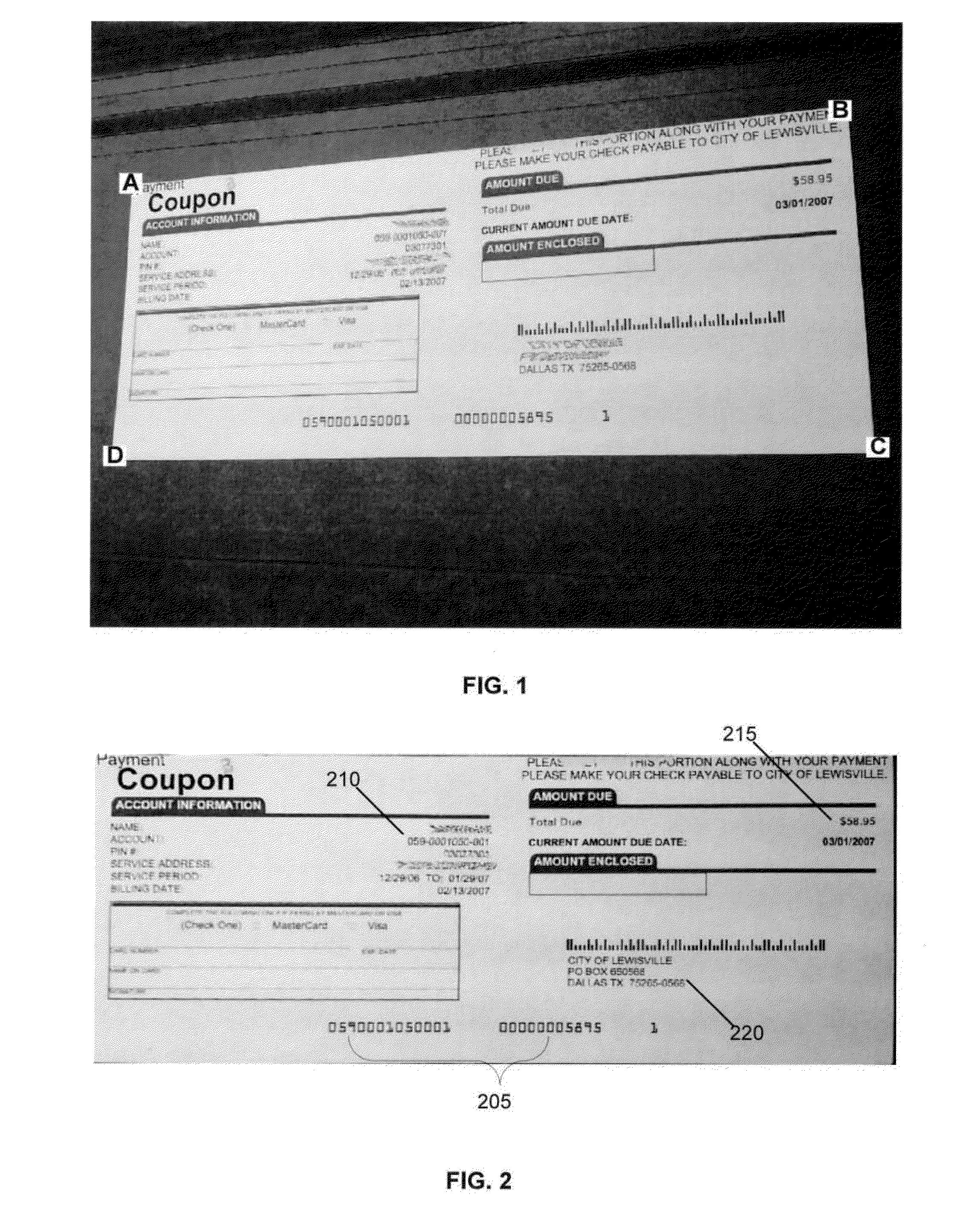

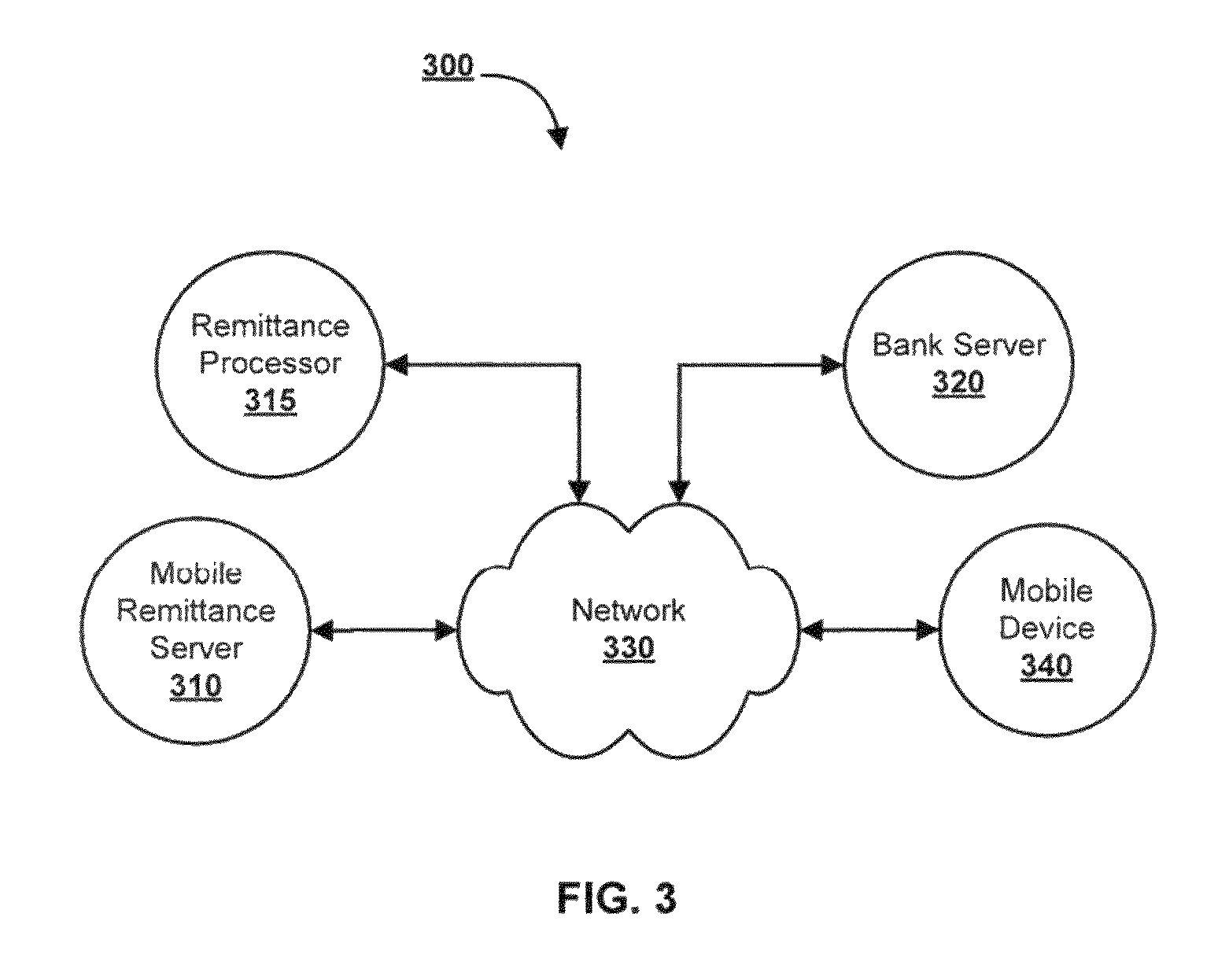

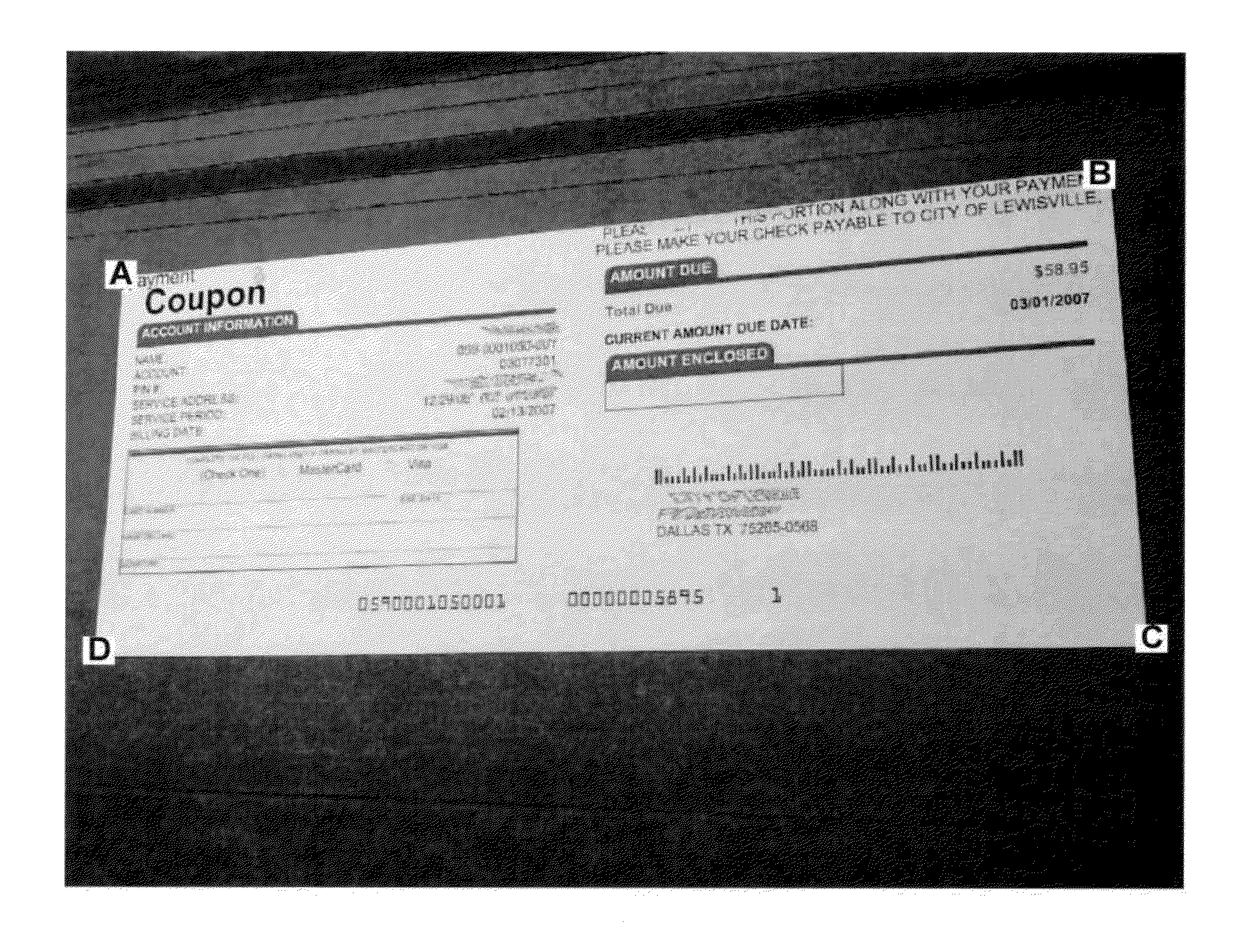

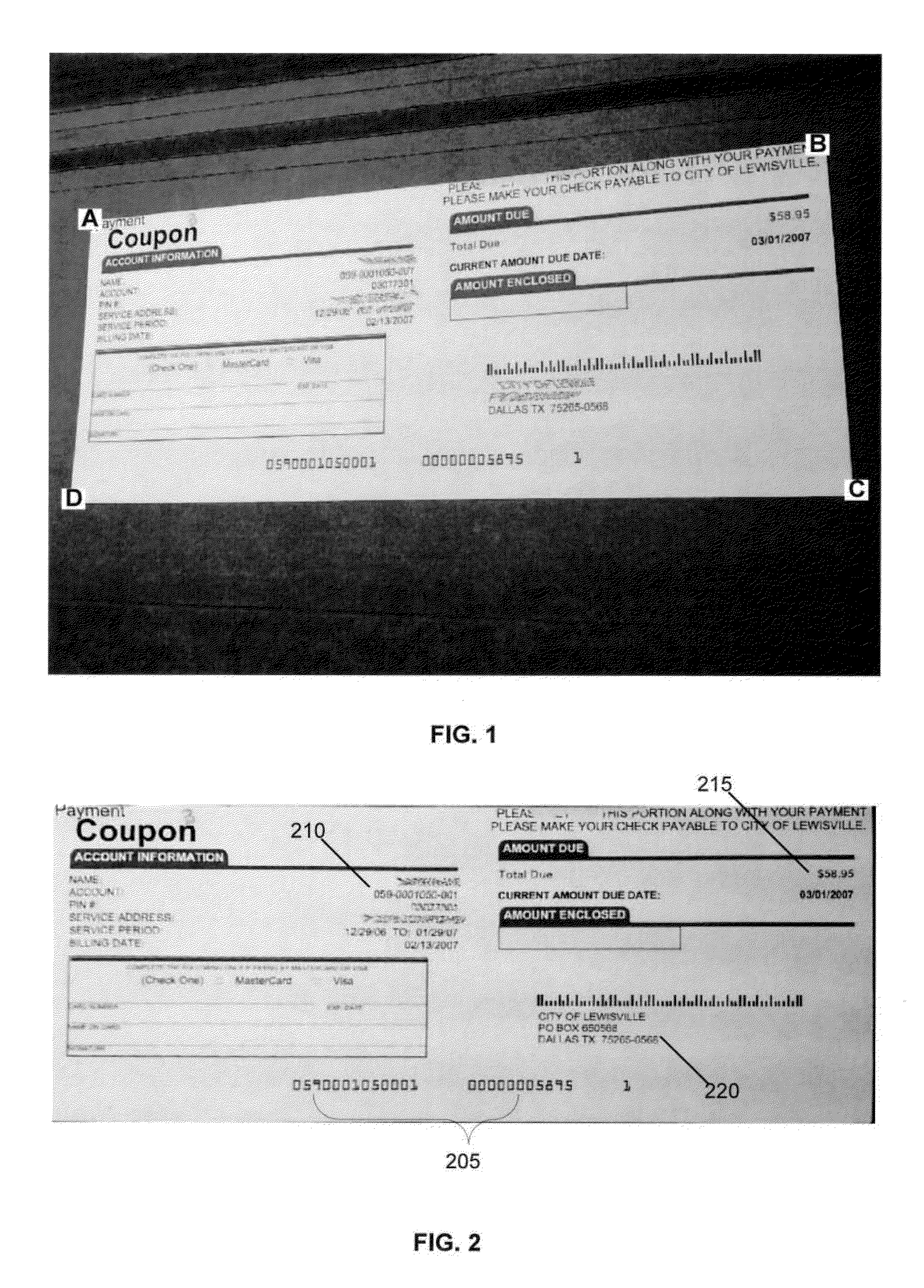

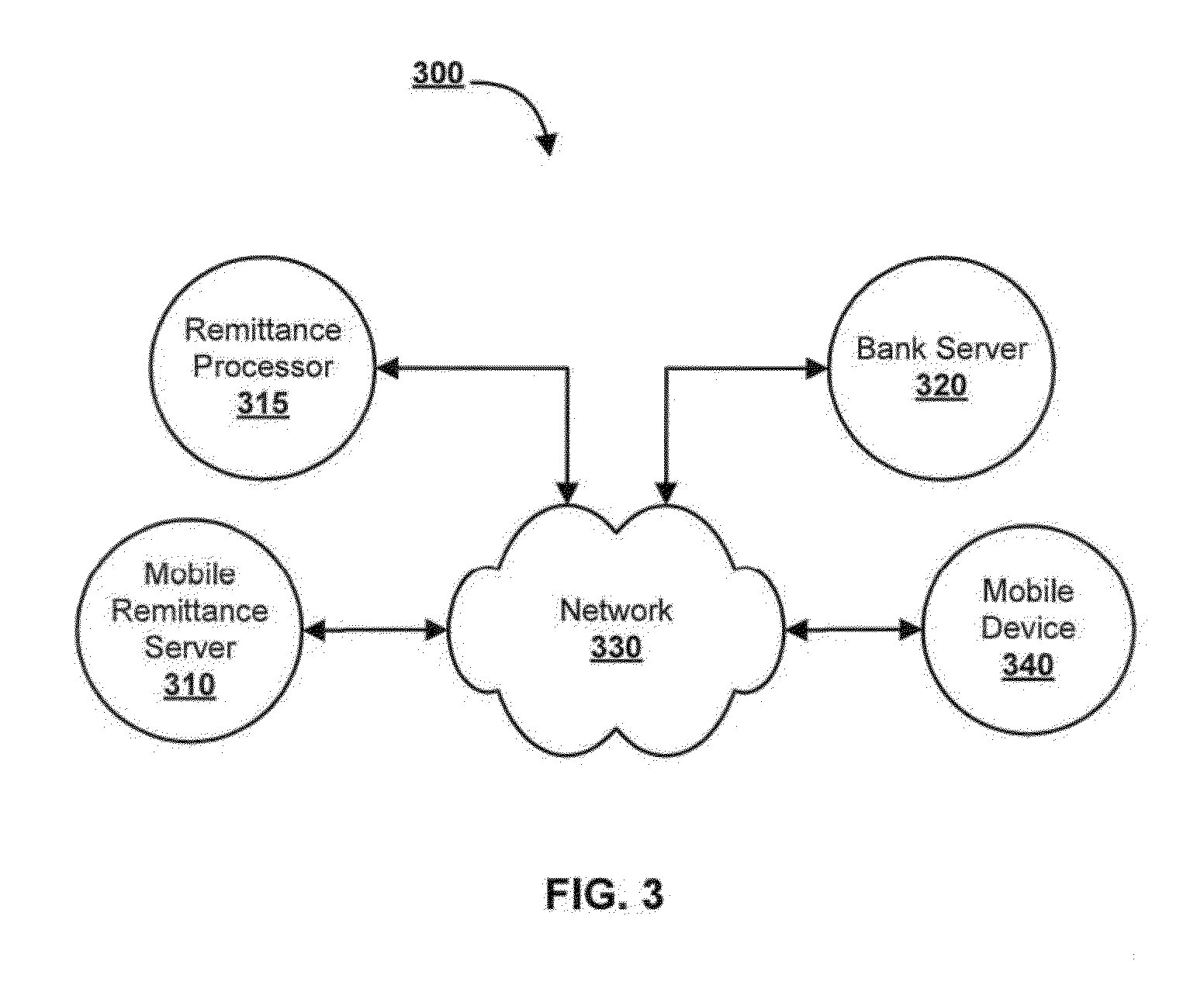

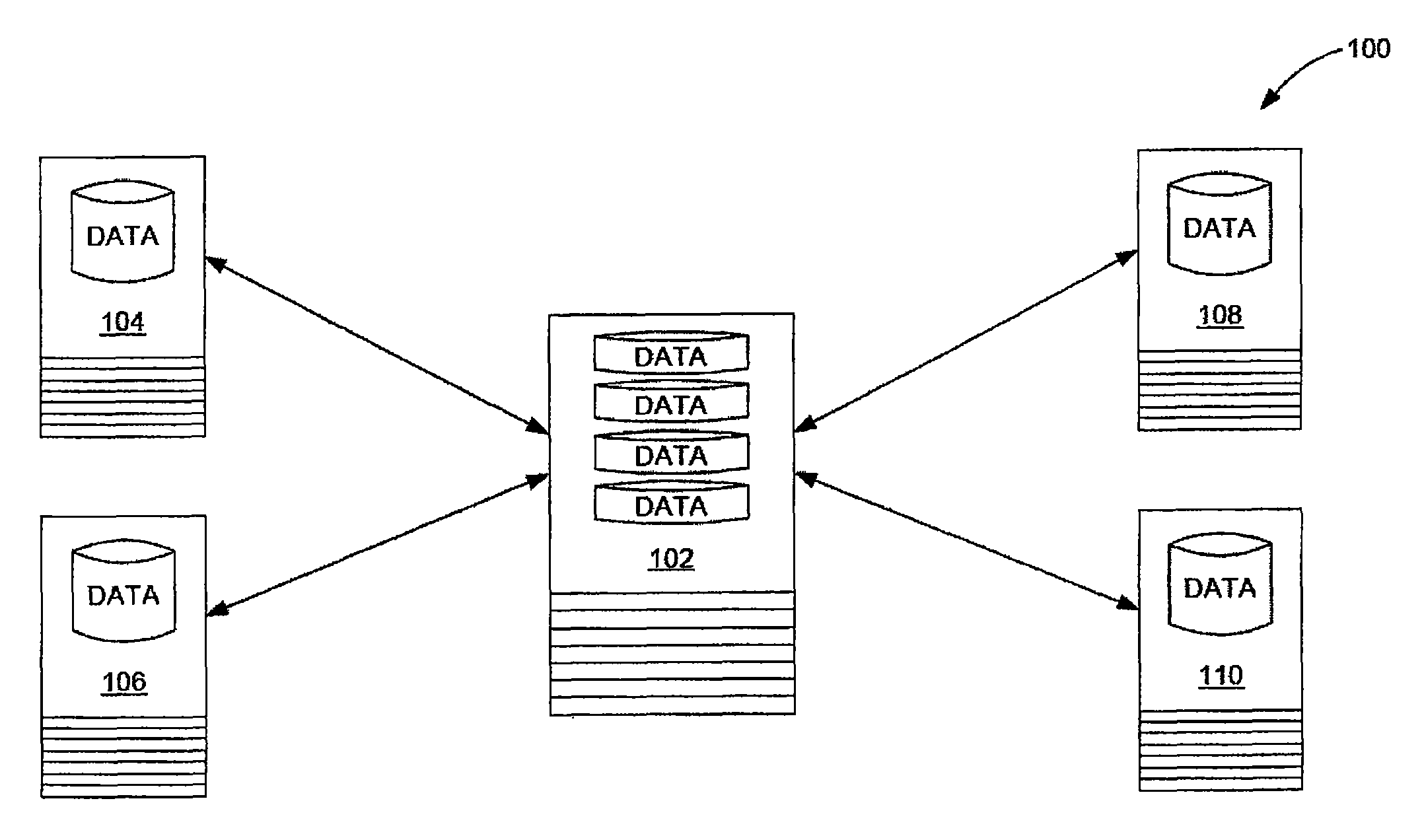

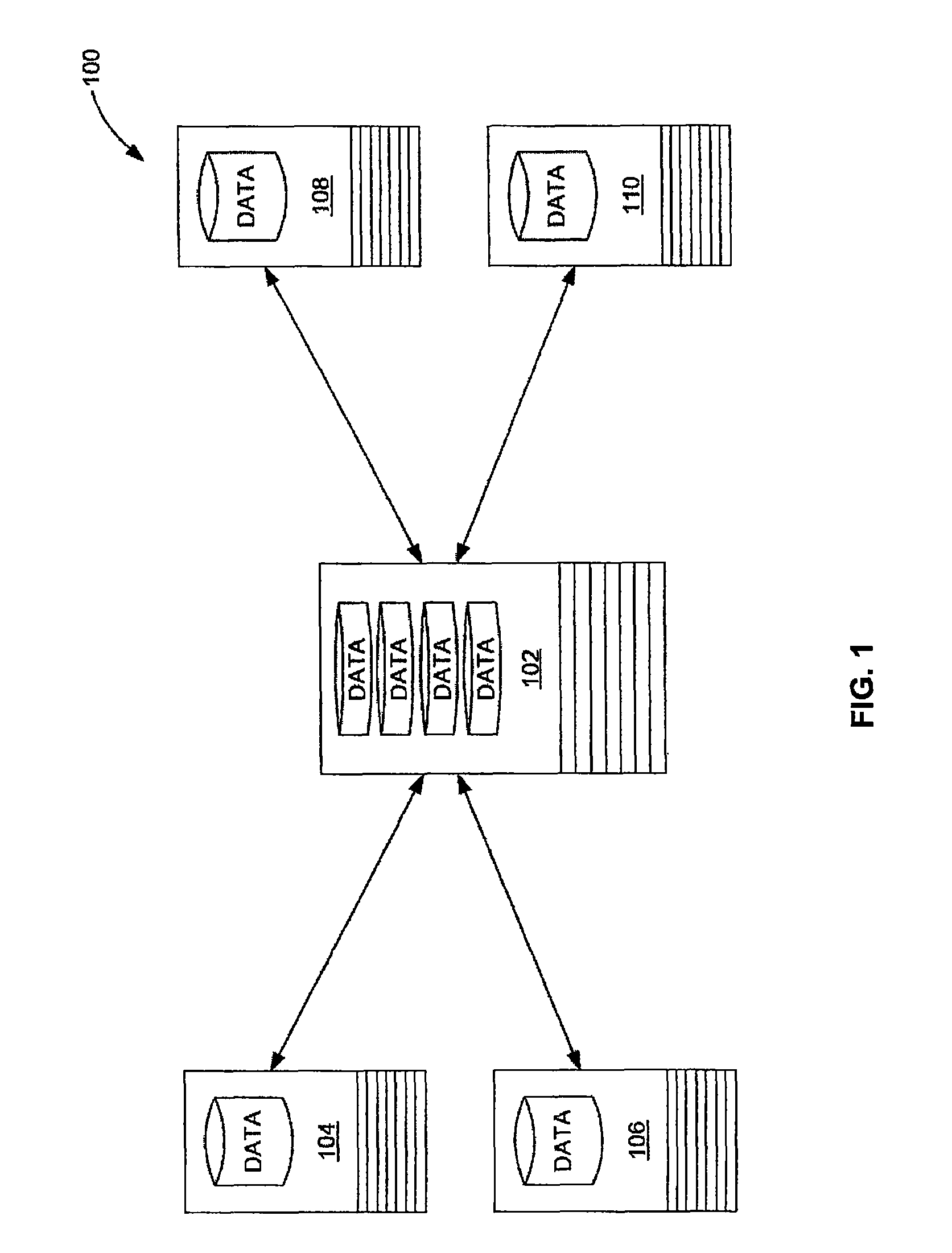

Systems and methods for obtaining financial offers using mobile image capture

Systems and methods for applying for and creating balance transfers with a mobile device are provided. An image of a customer's financial statement can be taken using a mobile device, after which the image is analyzed to extract information relevant to creating a balance transfer. The extracted information is then communicated to a bank over a network connected with the mobile device, where the bank can process the information and create an offer to the customer for a balance transfer in real-time. An example financial statement is a credit card statement. These systems and methods may comprise capturing an image of a document using a mobile communication device; transmitting the image to a server; detecting relevant information within the image; transmitting the information to a bank; and transmitting a resulting balance transfer offer from the bank to the mobile device.

Owner:MITEK SYST

Method and appraratus for development and use of a credit score based on spend capacity

ActiveUS20100223168A1Efficient use ofEfficient managementComplete banking machinesMarket predictionsBalance transferData source

Share of Wallet (“SOW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumers spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. A SOW score focusing on a consumer's spending capability can be used in the same manner as a credit bureau score.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

Method and apparatus for rating asset-backed securities

ActiveUS7610243B2Efficient use ofEfficient managementFinanceInput/output processes for data processingBalance transferData source

Share of Wallet (“SOW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumer's spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. The likelihood of default determined by the SOW model, when applied to a loan portfolio, can reduce the amount of credit enhancement required for an asset-backed securities rating.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

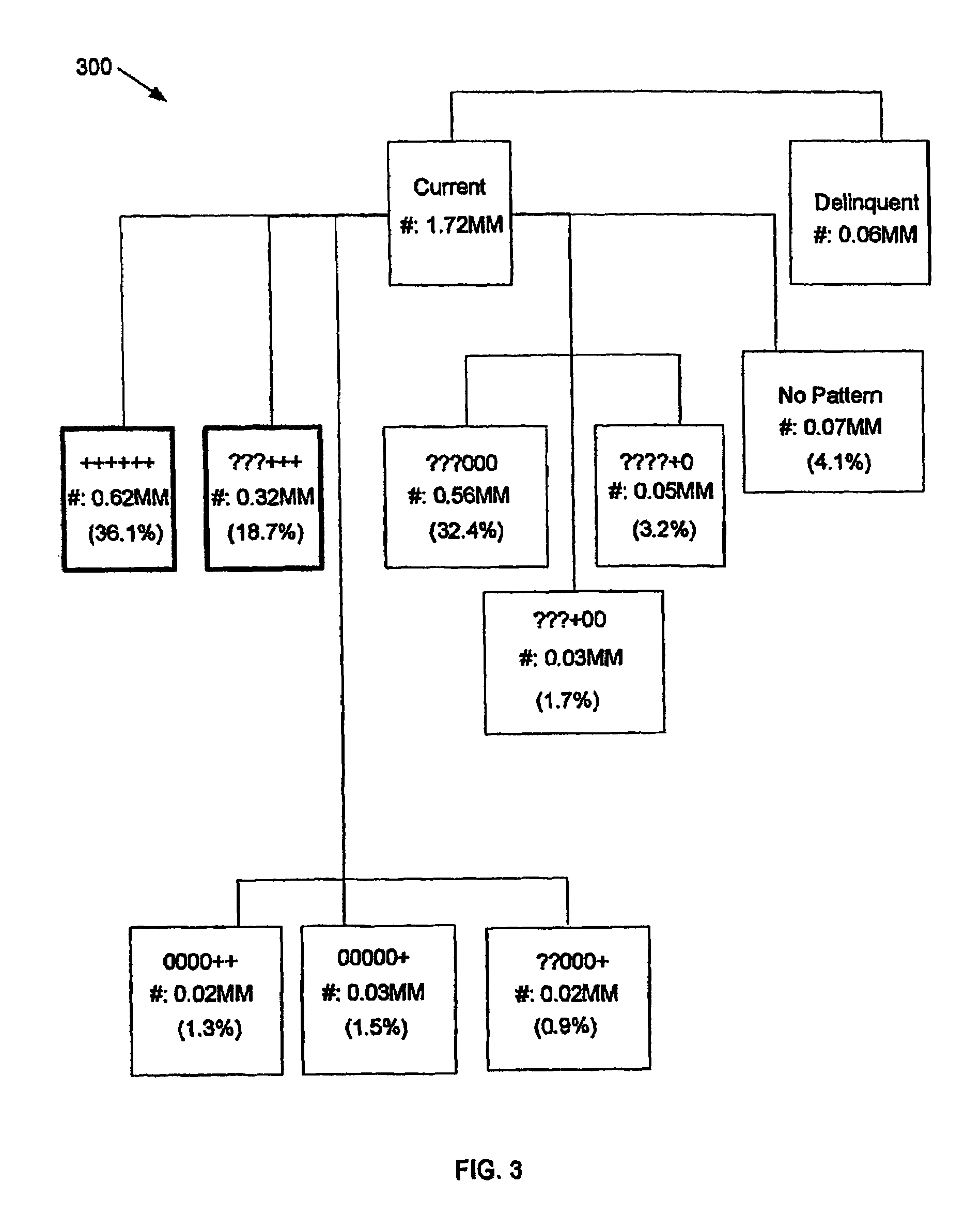

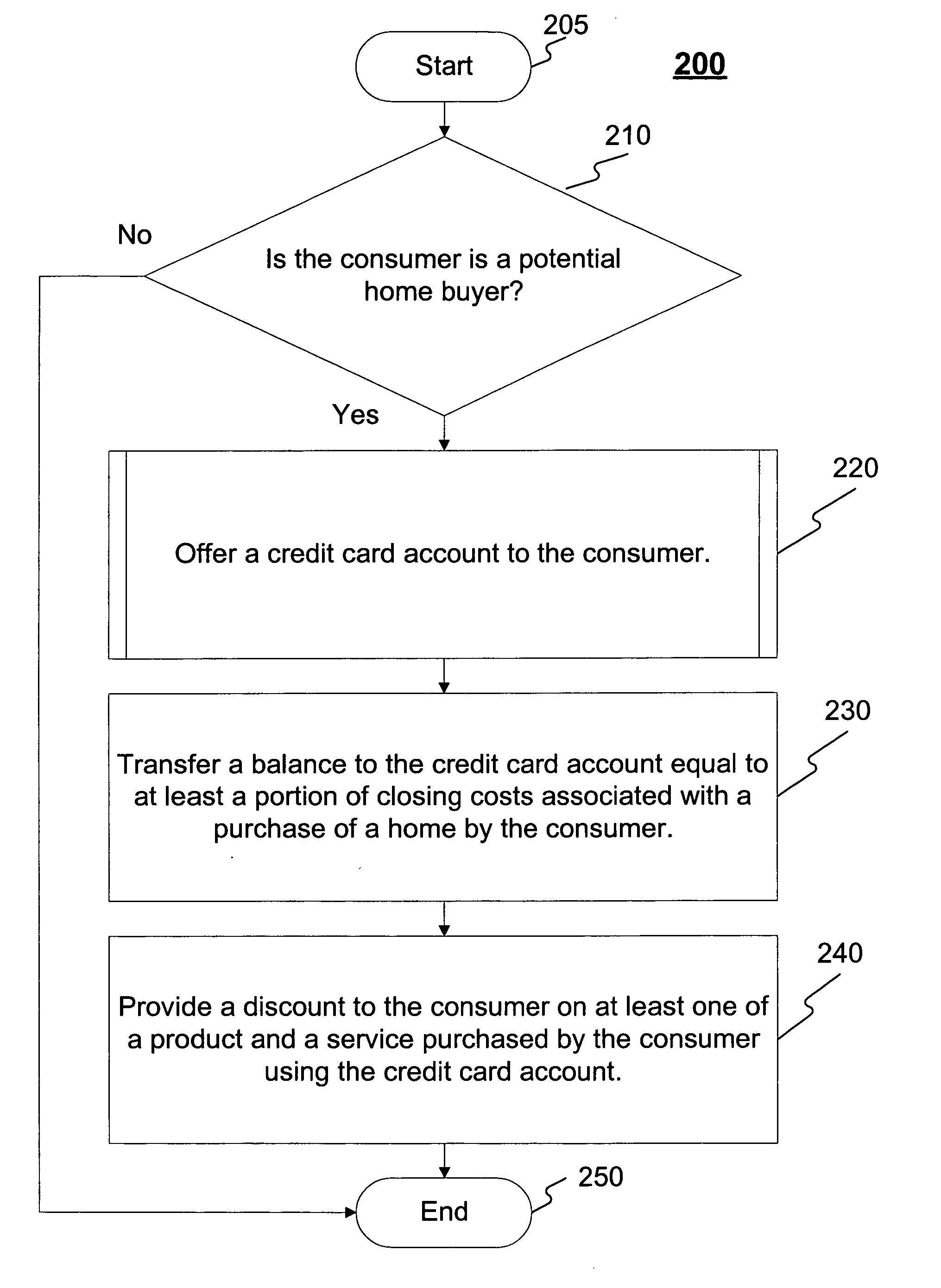

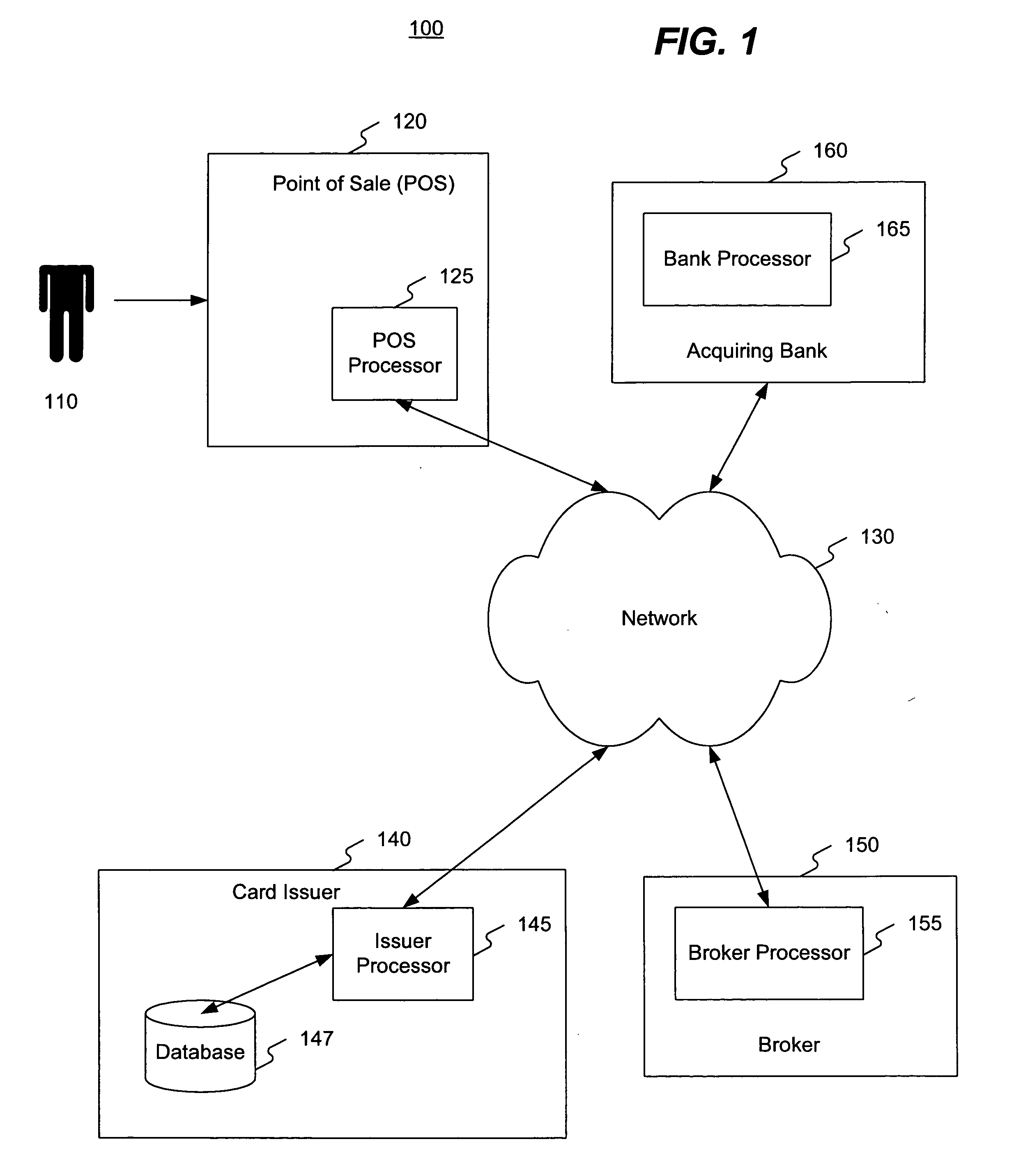

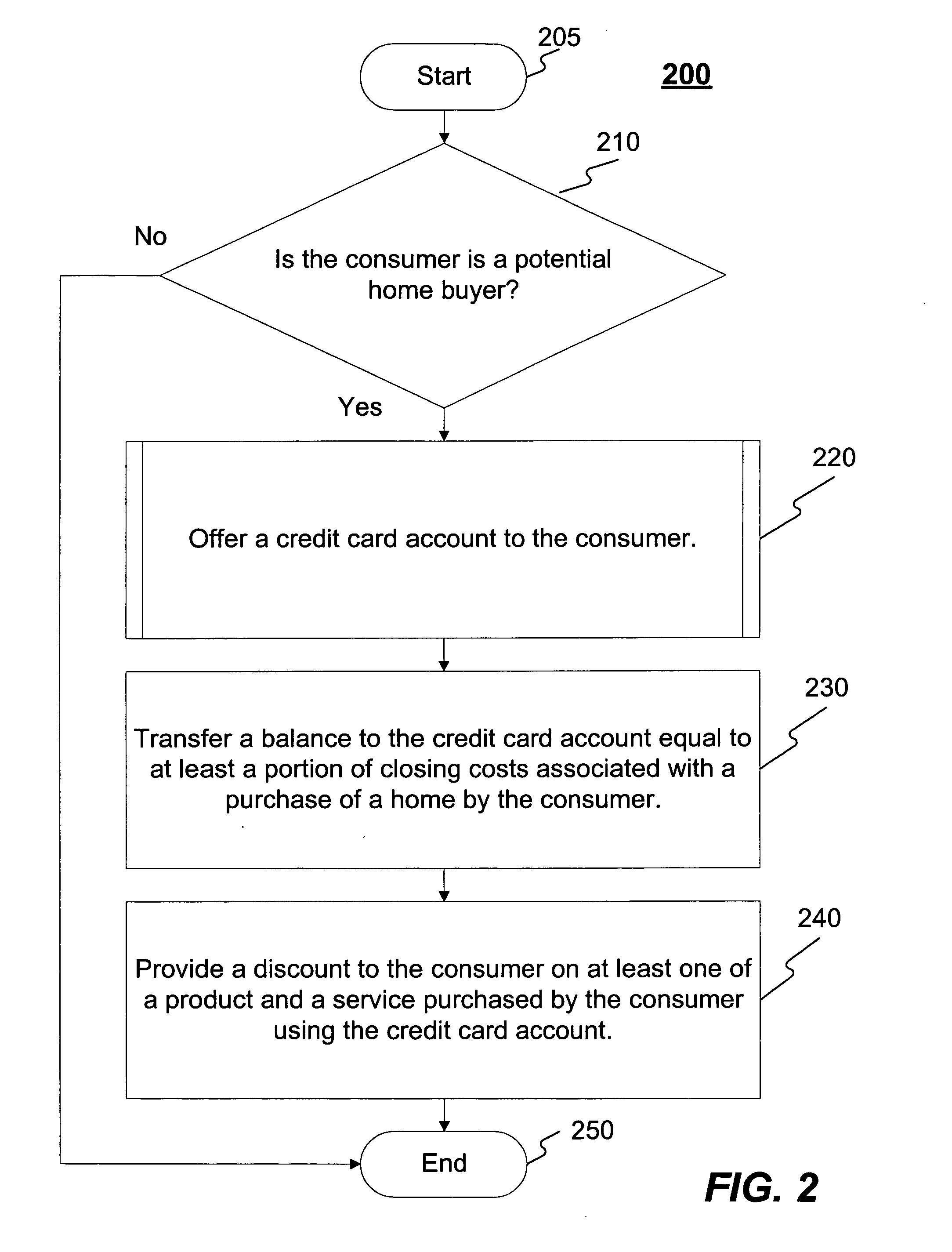

Methods and systems for offering a credit card account to a potential home buyer

Systems and methods are disclosed for offering a credit card account to a potential home buyer. The systems and methods may include determining if a consumer is a potential home buyer and offering a credit card account to the consumer if the consumer is a potential home buyer. Next, the systems and methods may include transferring a balance to the credit card account equal to at least a portion of closing costs associated with the purchased home by the consumer. In addition, the systems and methods may include providing a discount to the consumer on items purchased by the consumer using the credit card account.

Owner:CAPITAL ONE FINANCIAL

Method and apparatus for development and use of a credit score based on spend capacity

Share of Wallet (“SOW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumers spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. A SOW score focusing on a consumer's spending capability can be used in the same manner as a credit bureau score.

Owner:EXPERIAN MARKETING SOLUTIONS

Credit score and scorecard development

Share of Wallet (“SOW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumers spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. The outputs can be used as attributes to consider in developing a credit bureau scorecard.

Owner:EXPERIAN MARKETING SOLUTIONS

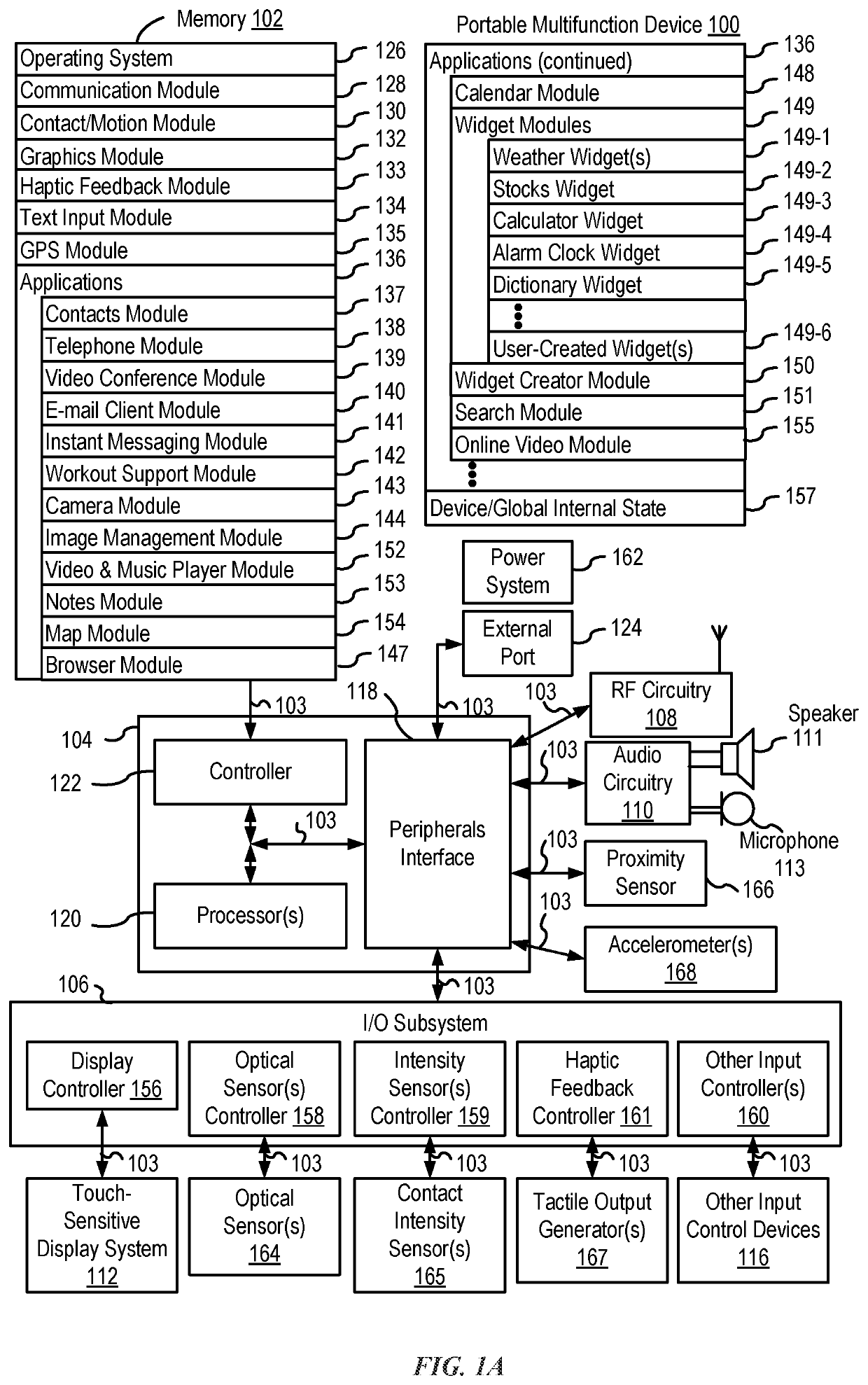

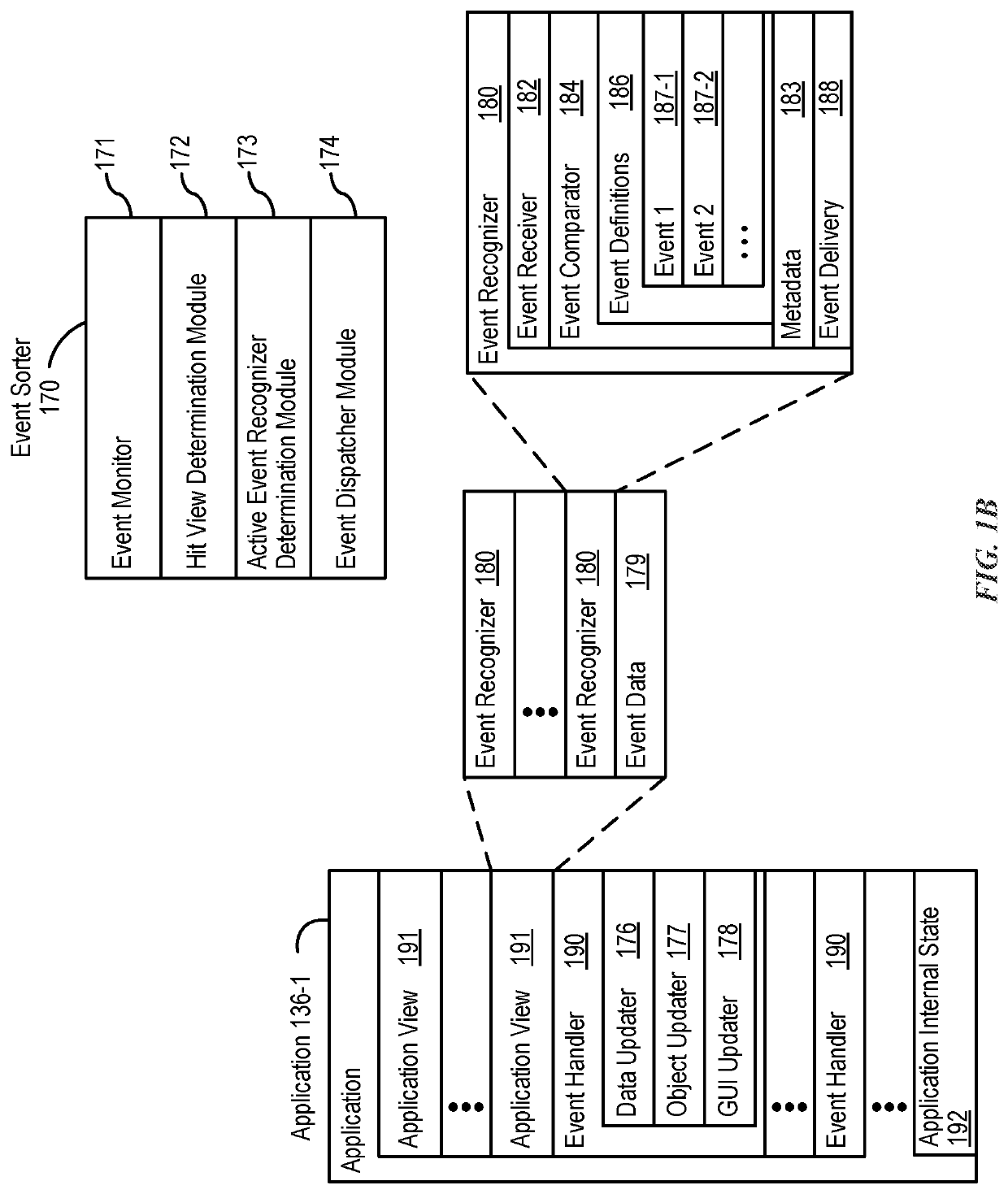

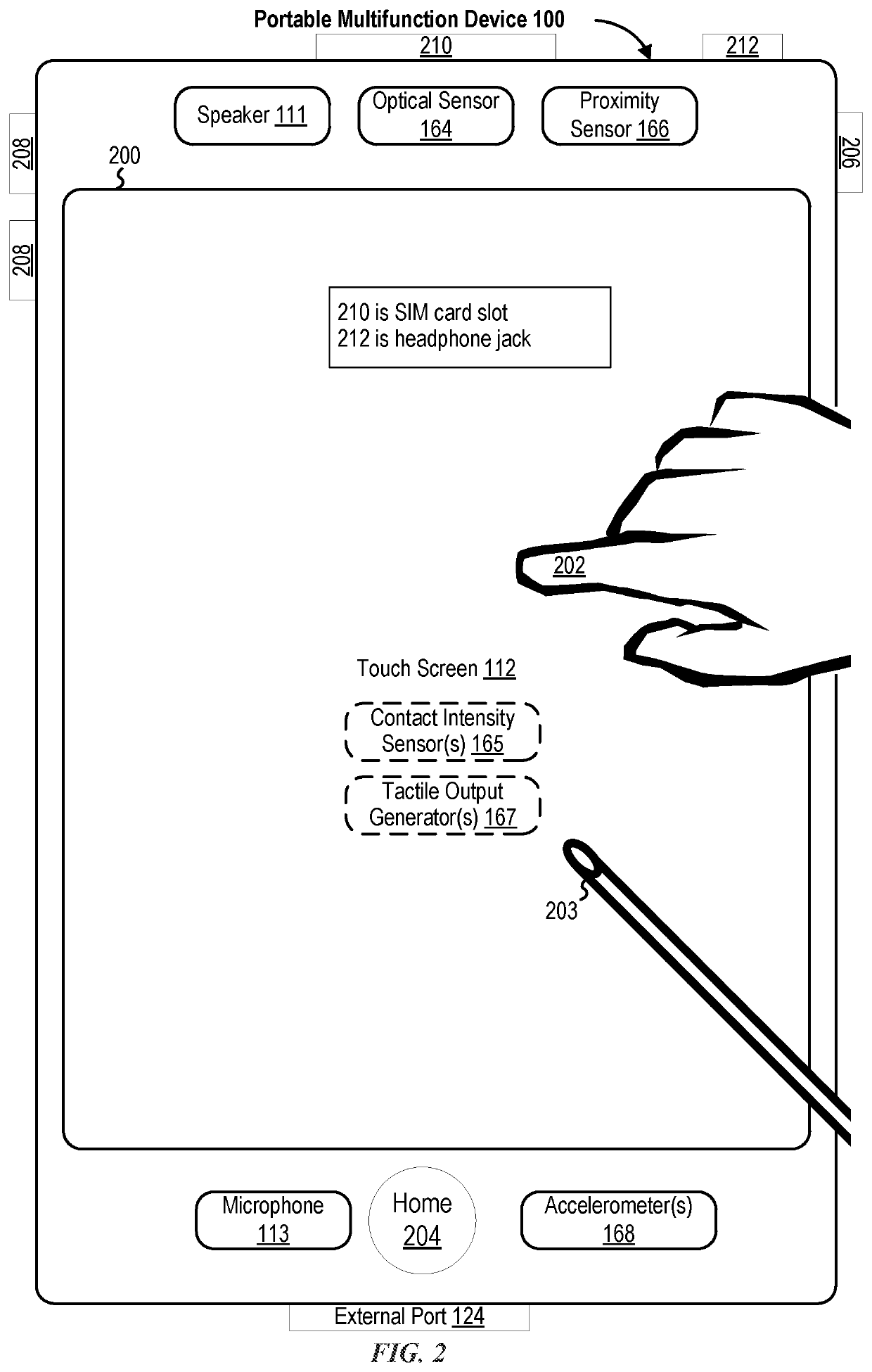

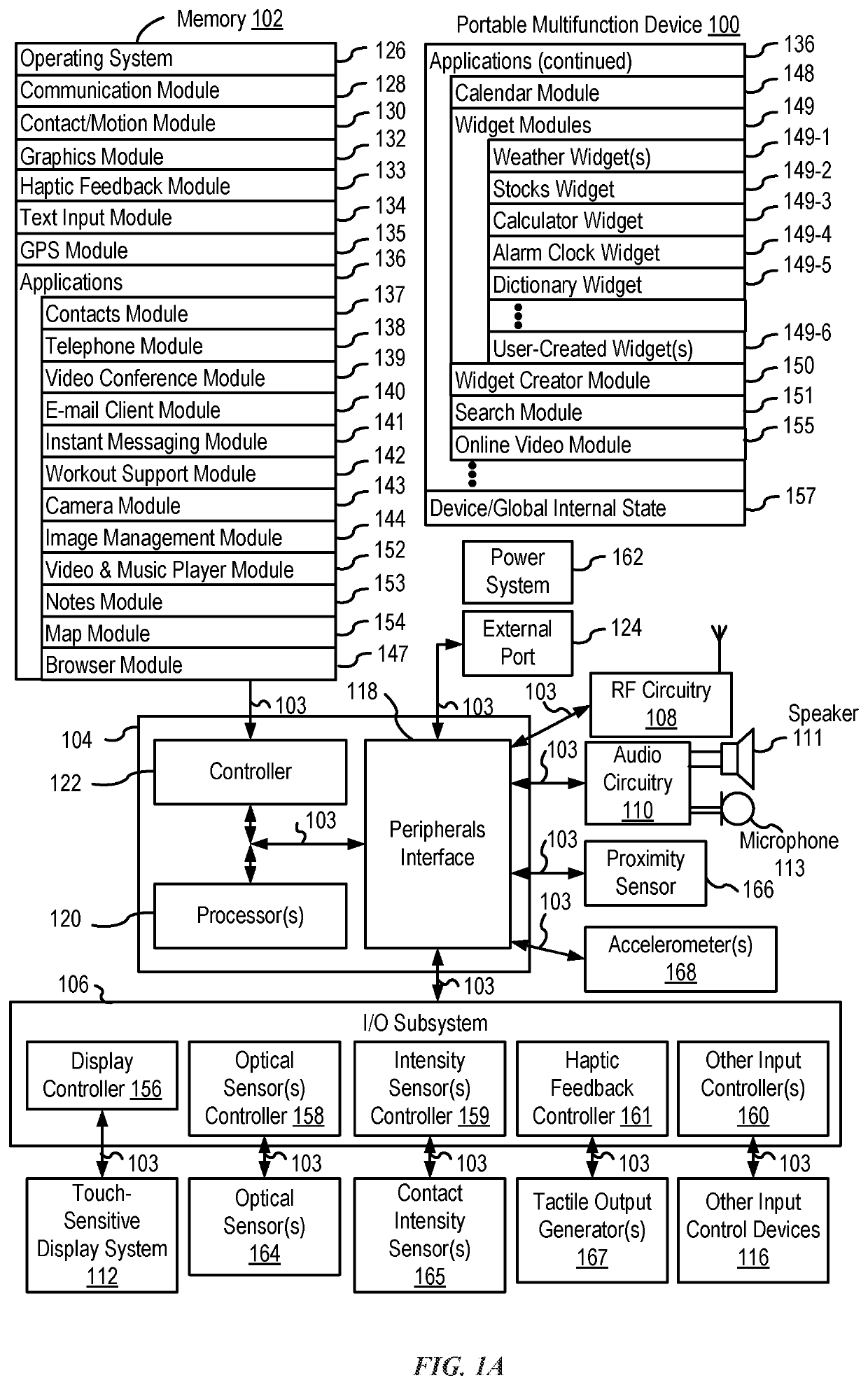

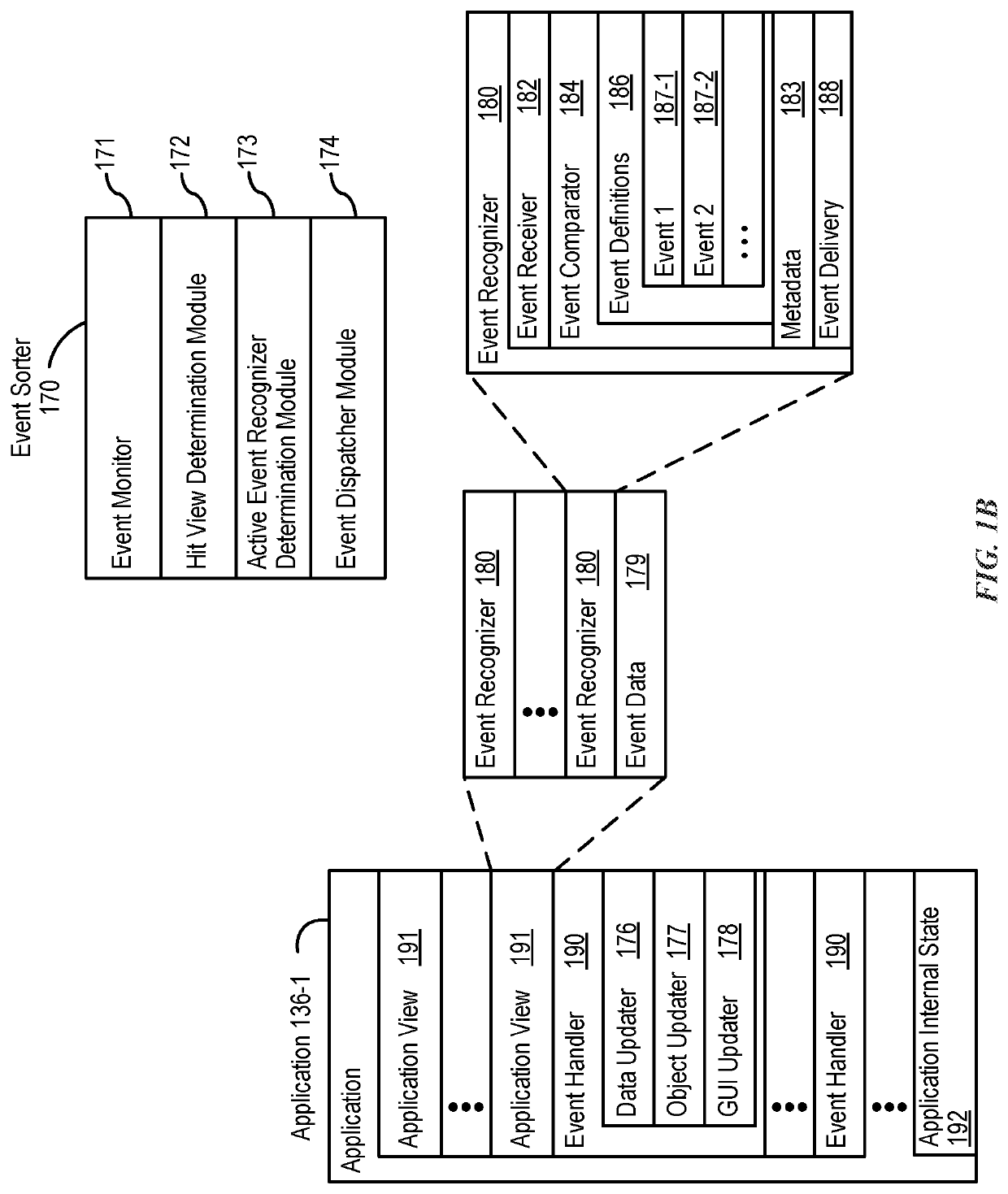

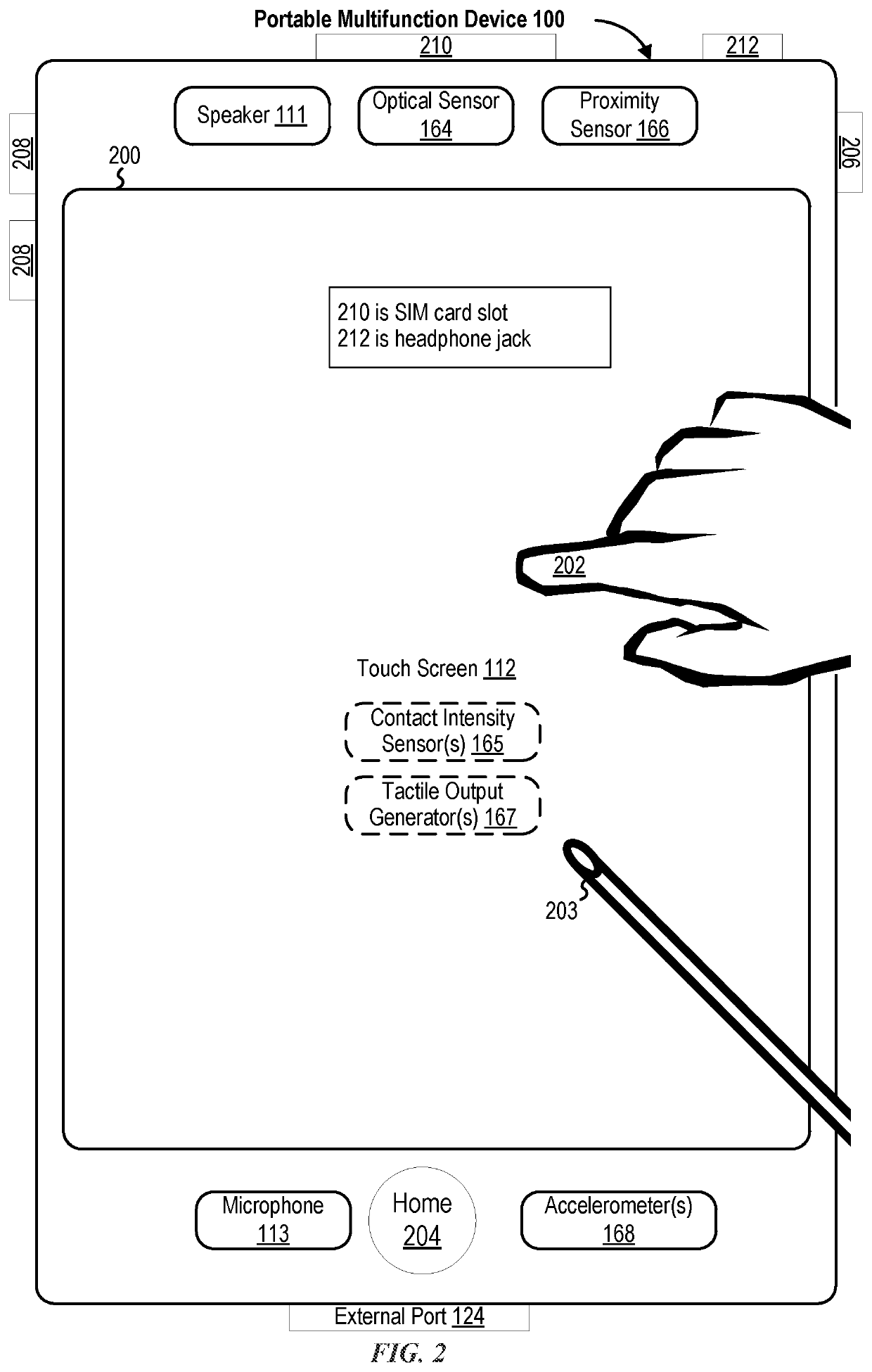

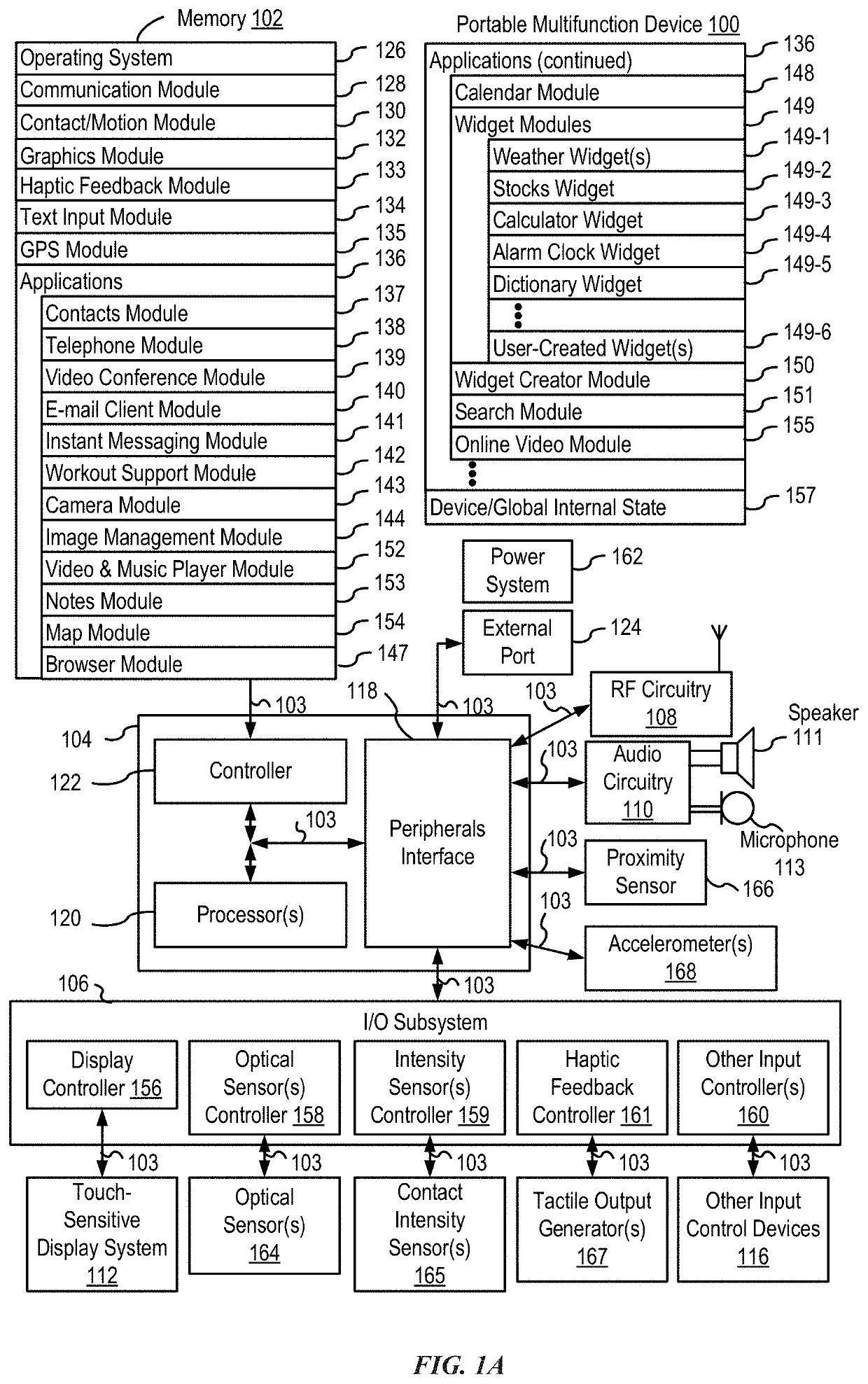

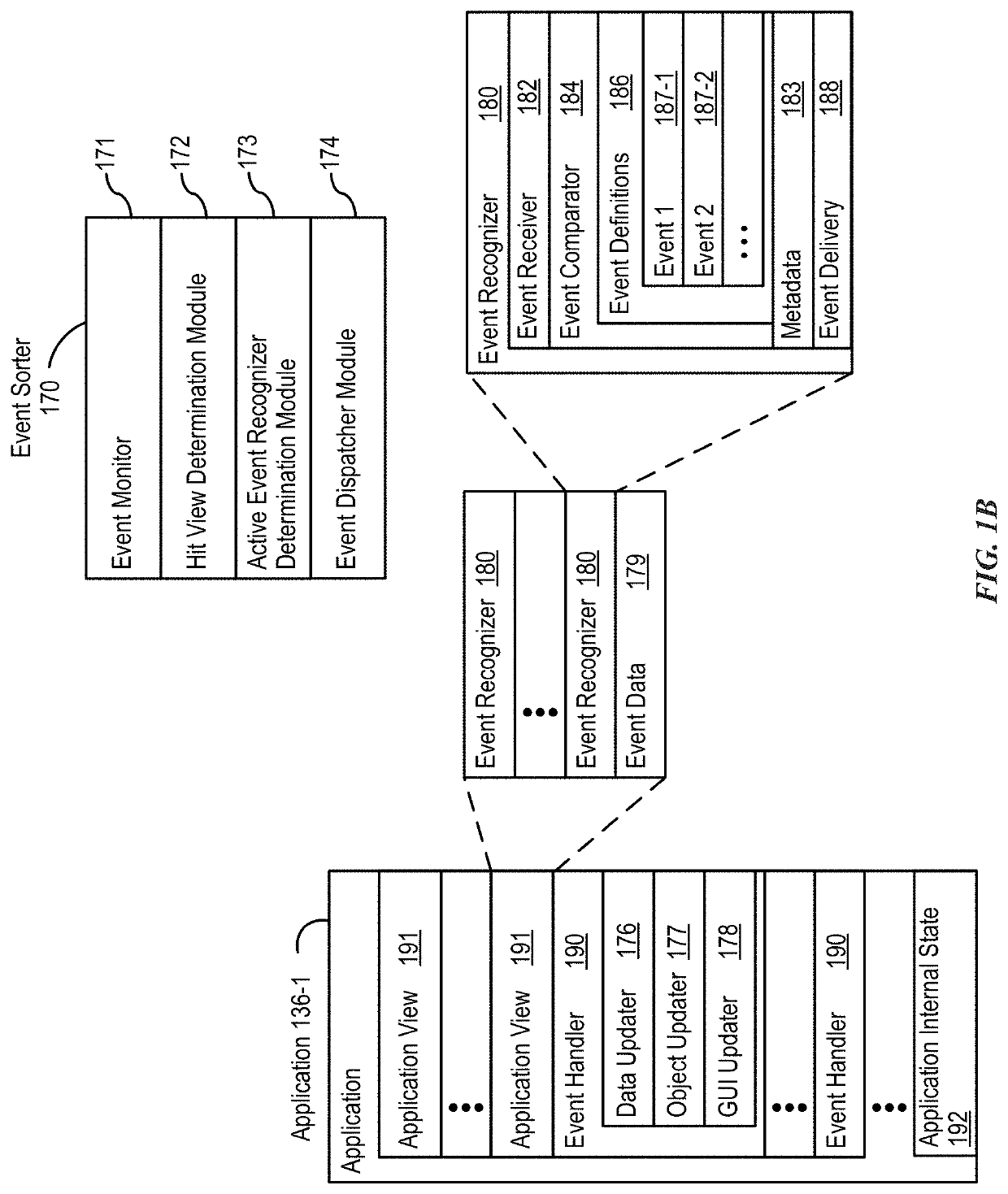

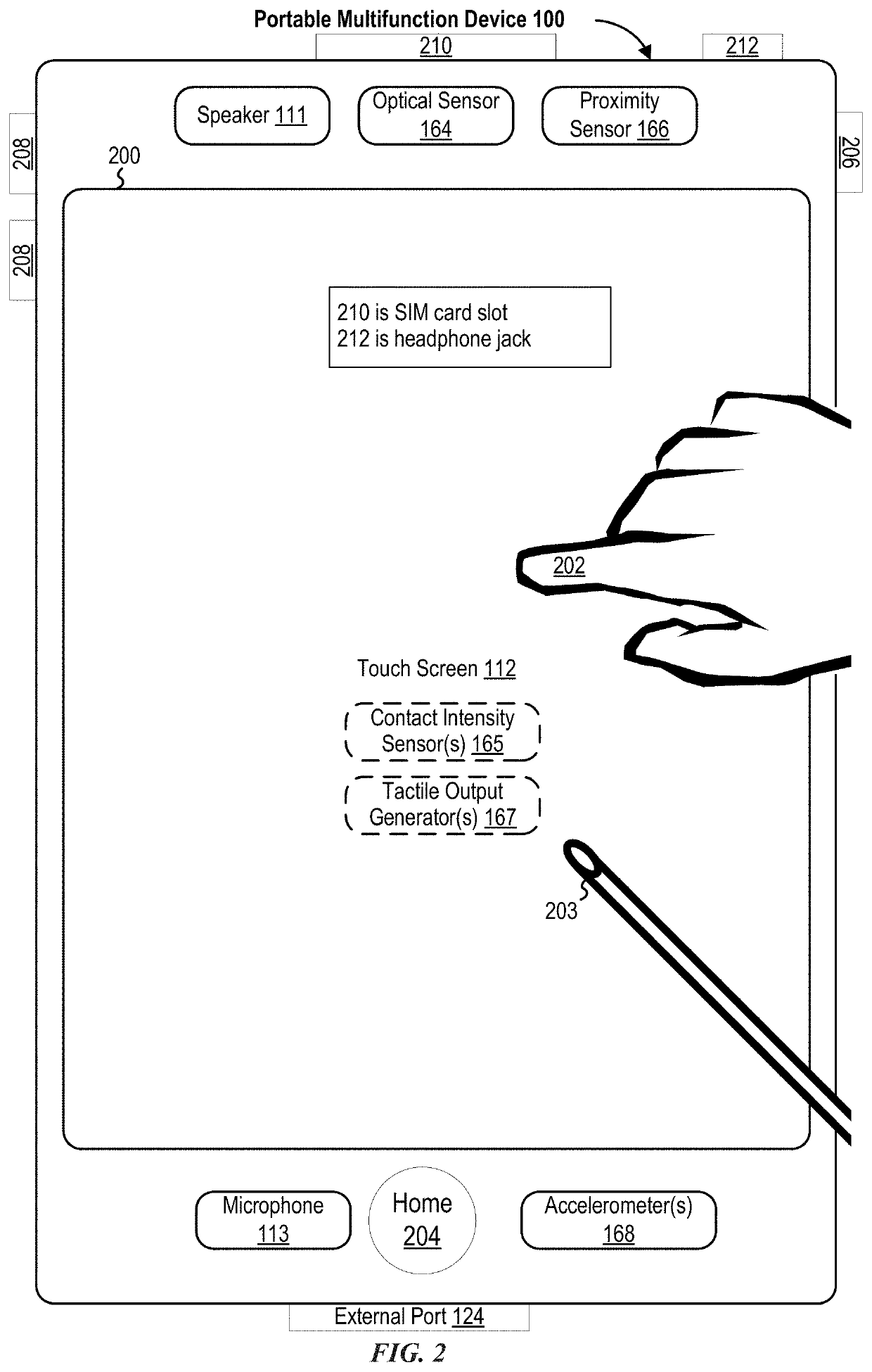

User interfaces for managing an account

ActiveUS10783576B1Faster and efficient methodFaster and efficient and interfaceDatabase queryingFinanceBalance transferEngineering

In some embodiments, exemplary user interfaces for provisioning an electronic device with an account are described. In some embodiments, exemplary user interfaces for providing usage information of an account are described. In some embodiments, exemplary user interfaces for providing visual feedback on a representation of an account are described. In some embodiments, exemplary user interfaces for managing the tracking of a category are described. In some embodiments, exemplary user interfaces for managing a transfer of items are described. In some embodiments, exemplary user interfaces for managing an authentication credential connected with an account are described. In some embodiments, exemplary user interfaces for activating a physical account object are described. In some embodiments, exemplary user interfaces for managing balance transfers are described.

Owner:APPLE INC

Method and apparatus for rating asset-backed securities

Share of Wallet (“SoW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumer's spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. The likelihood of default determined by the SoW model, when applied to a loan portfolio, can reduce the amount of credit enhancement required for an asset-backed securities rating.

Owner:MEGDAL MYLES G +2

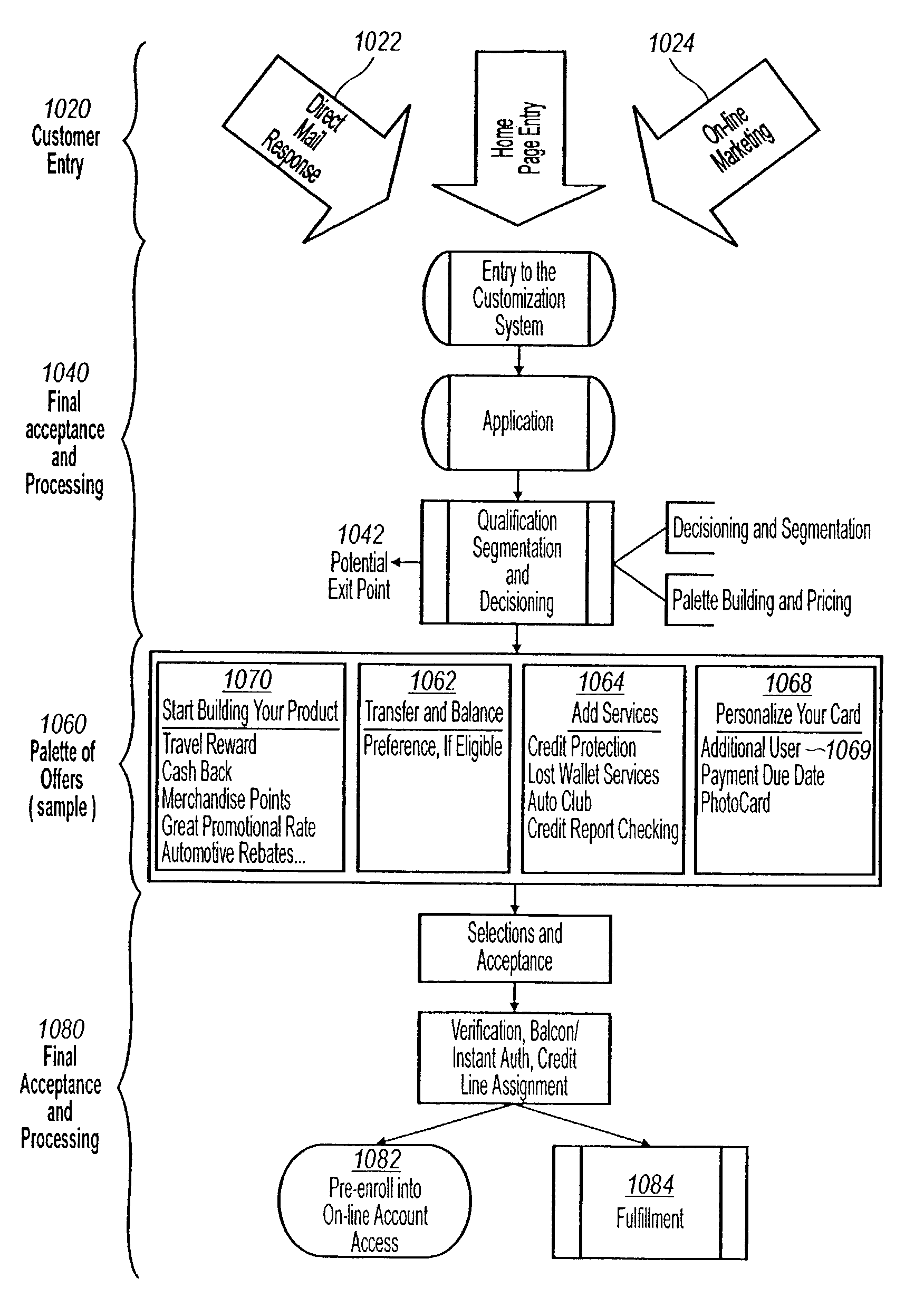

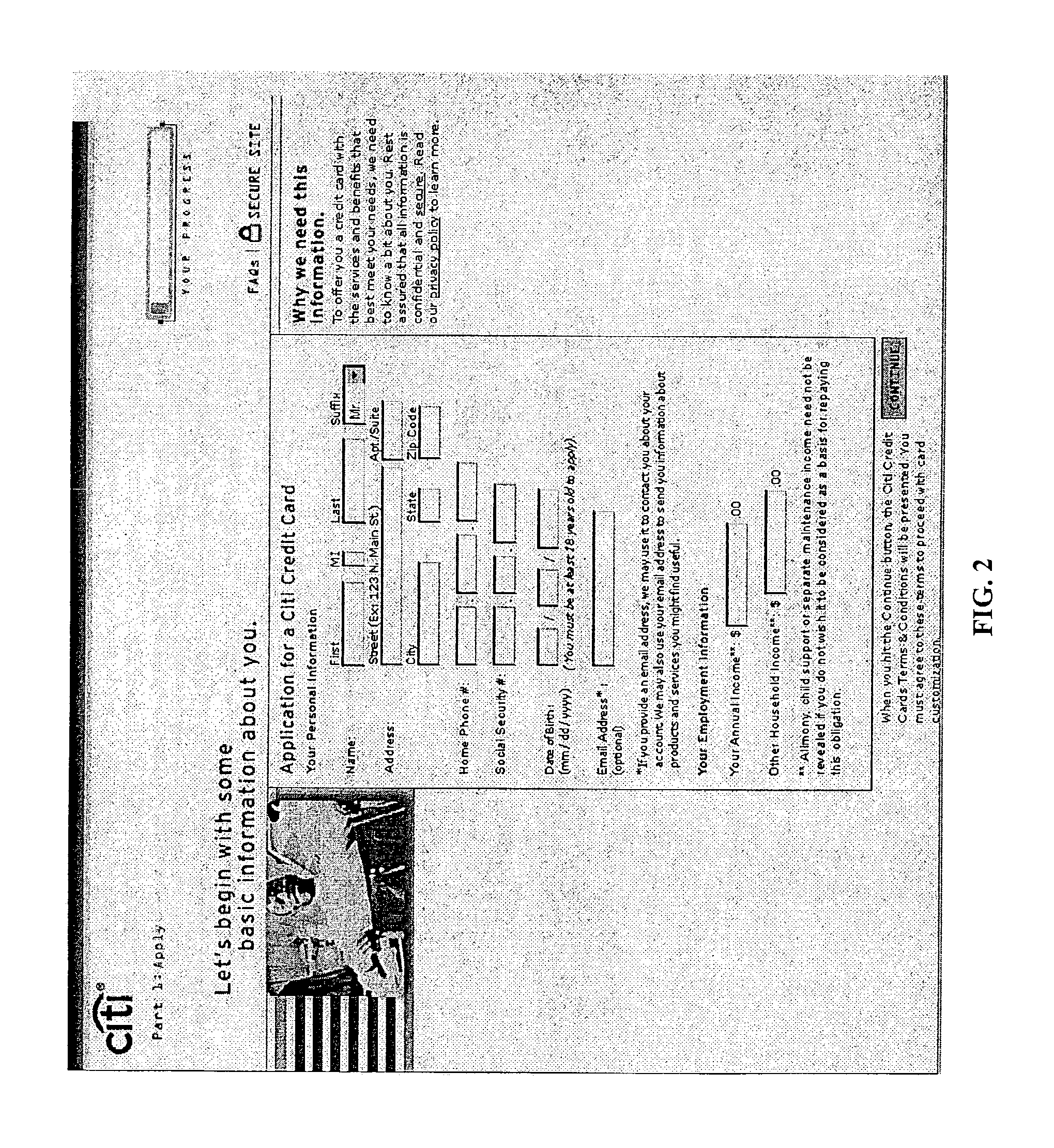

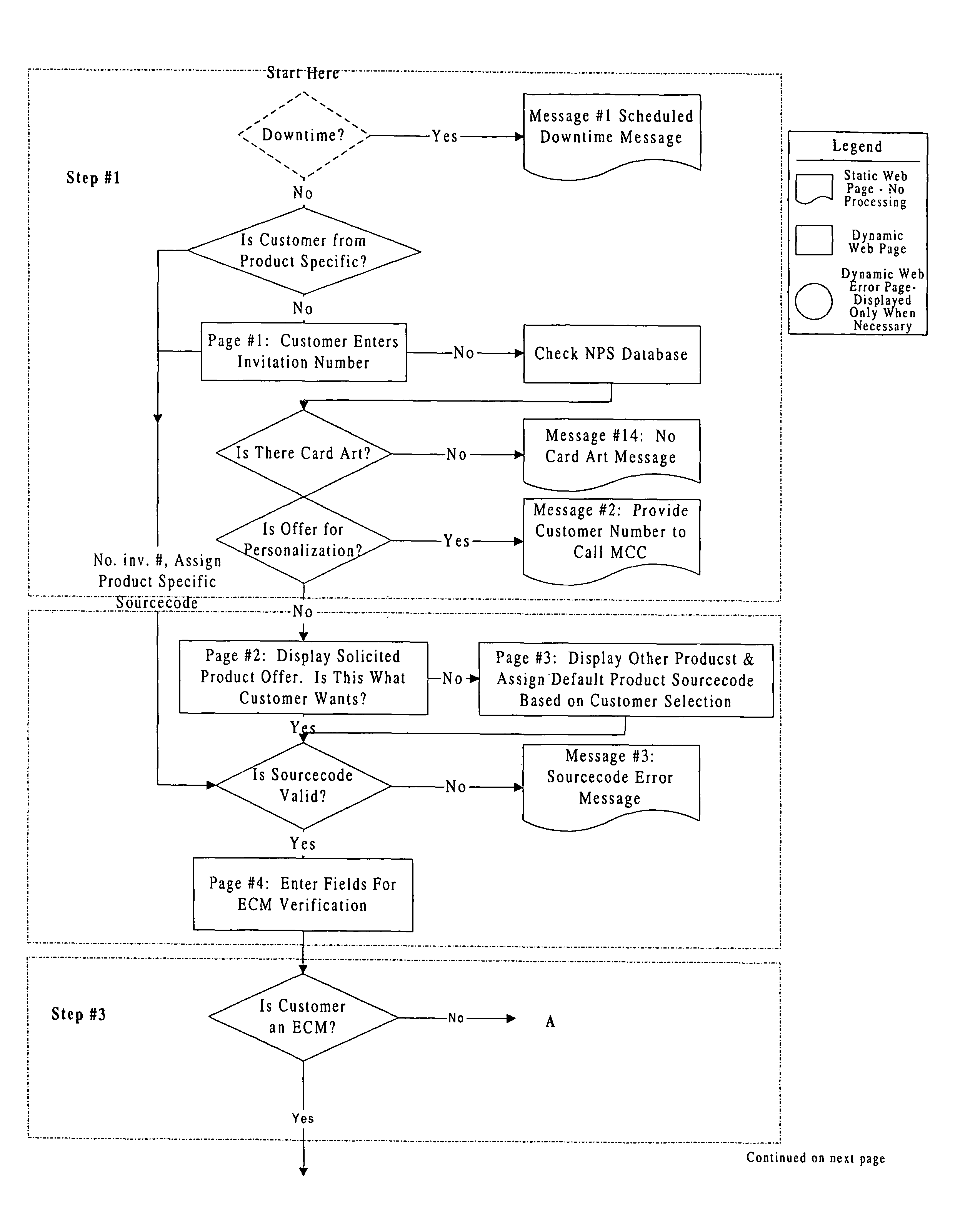

Establishing, modifying, and customizing account-based products

Providing an account-based product. A communications portal is provided and consumer data is received via the portal. At least one derived characteristic, e.g., qualification, is determined contemporaneously from the consumer data. A product set is presented, via the portal, including at least one product determined at least in part by the derived characteristic. A selection from the product set is received via the portal, and at least one product feature, e.g., balance transfer, of at least one selected product is activated contemporaneous with the product selection.

Owner:CITICORP CREDIT SERVICES INC (USA)

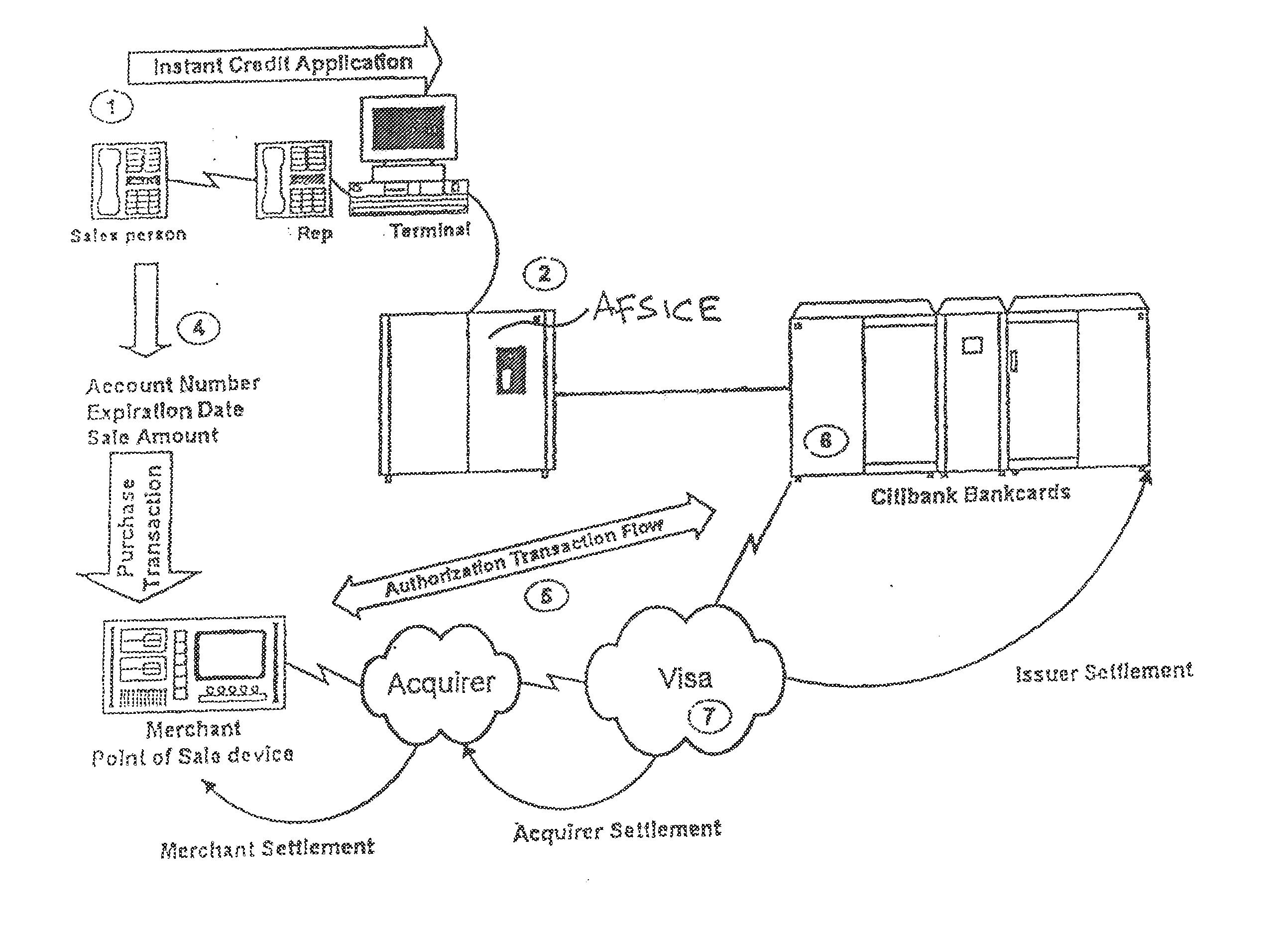

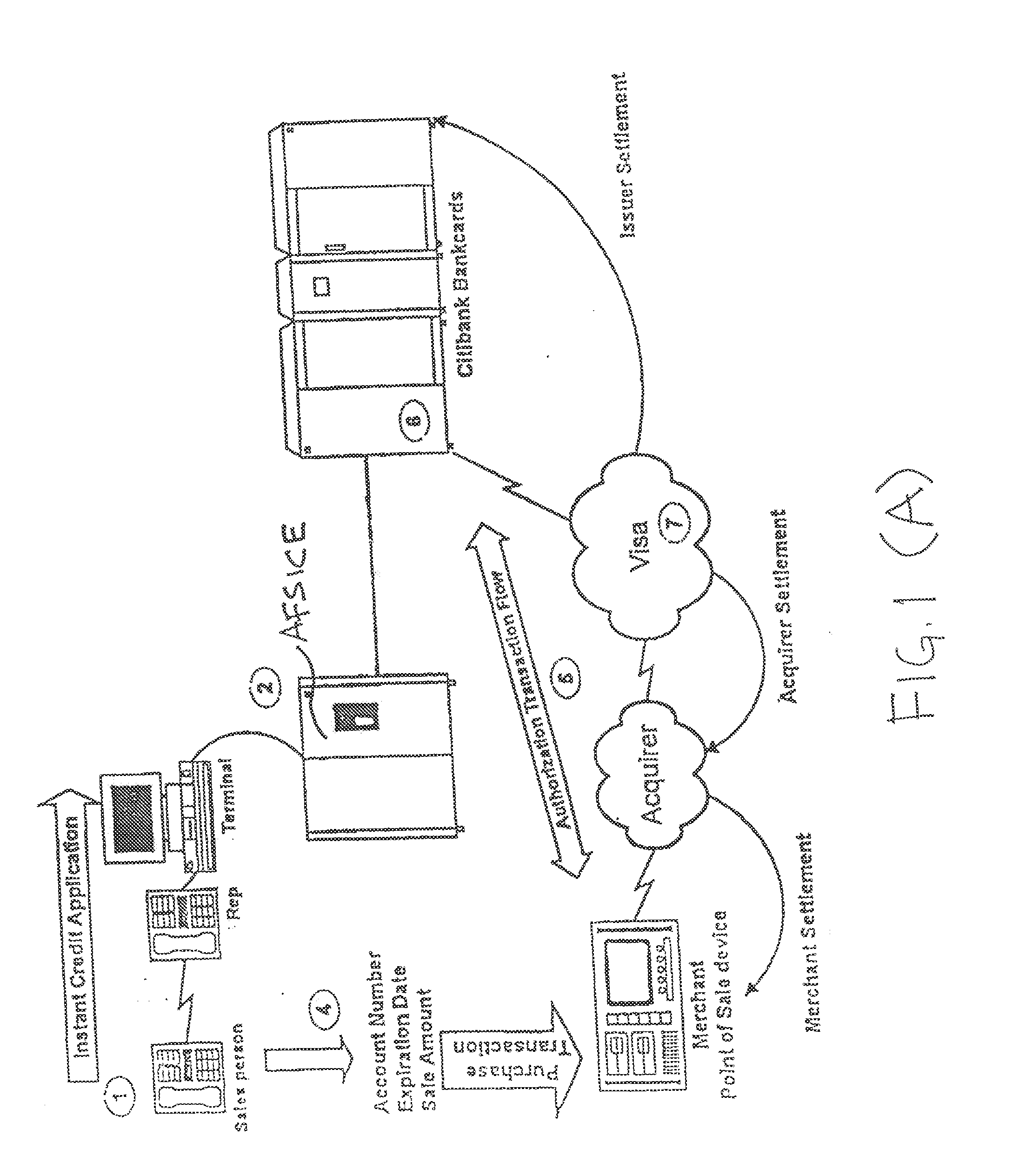

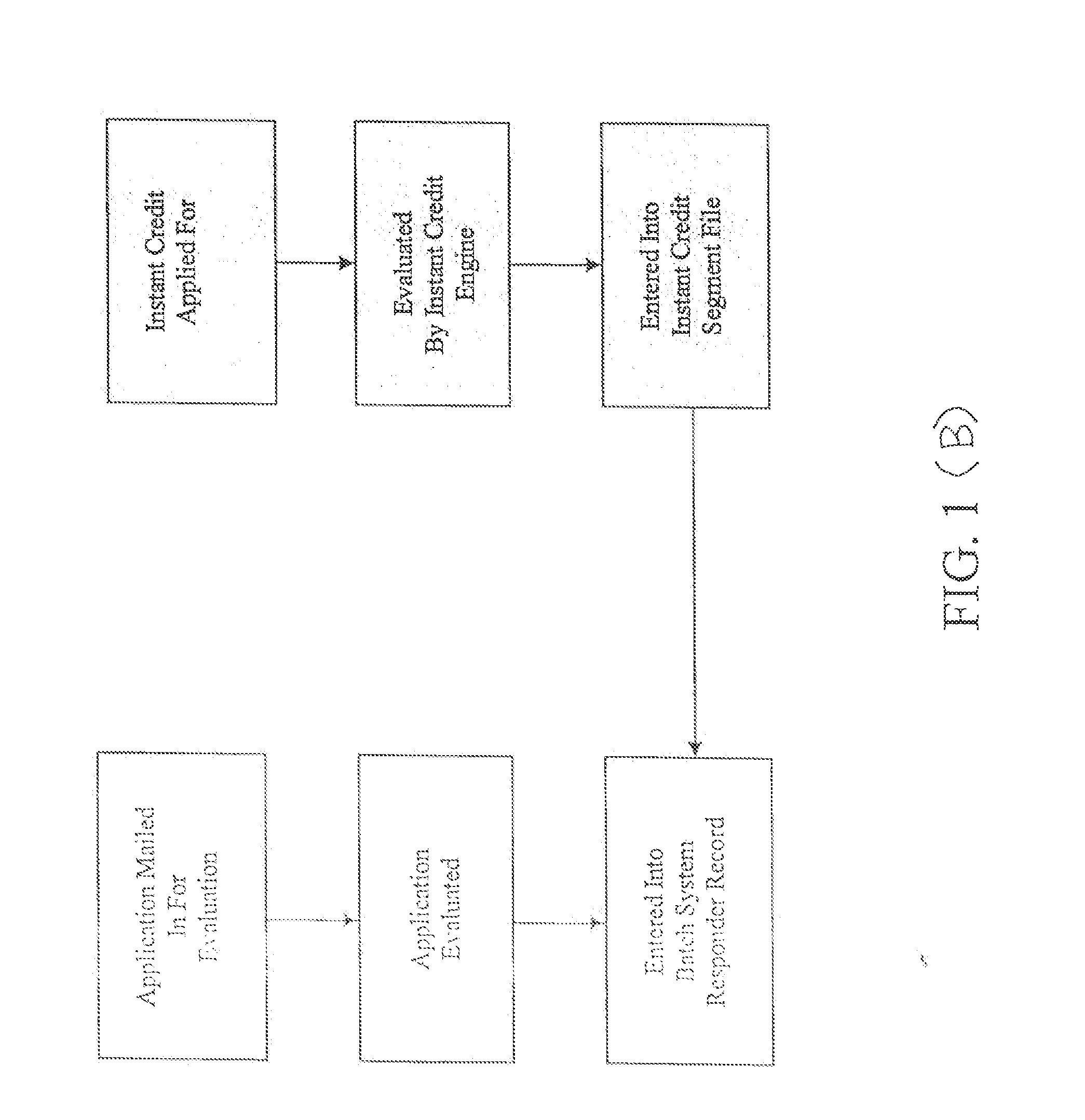

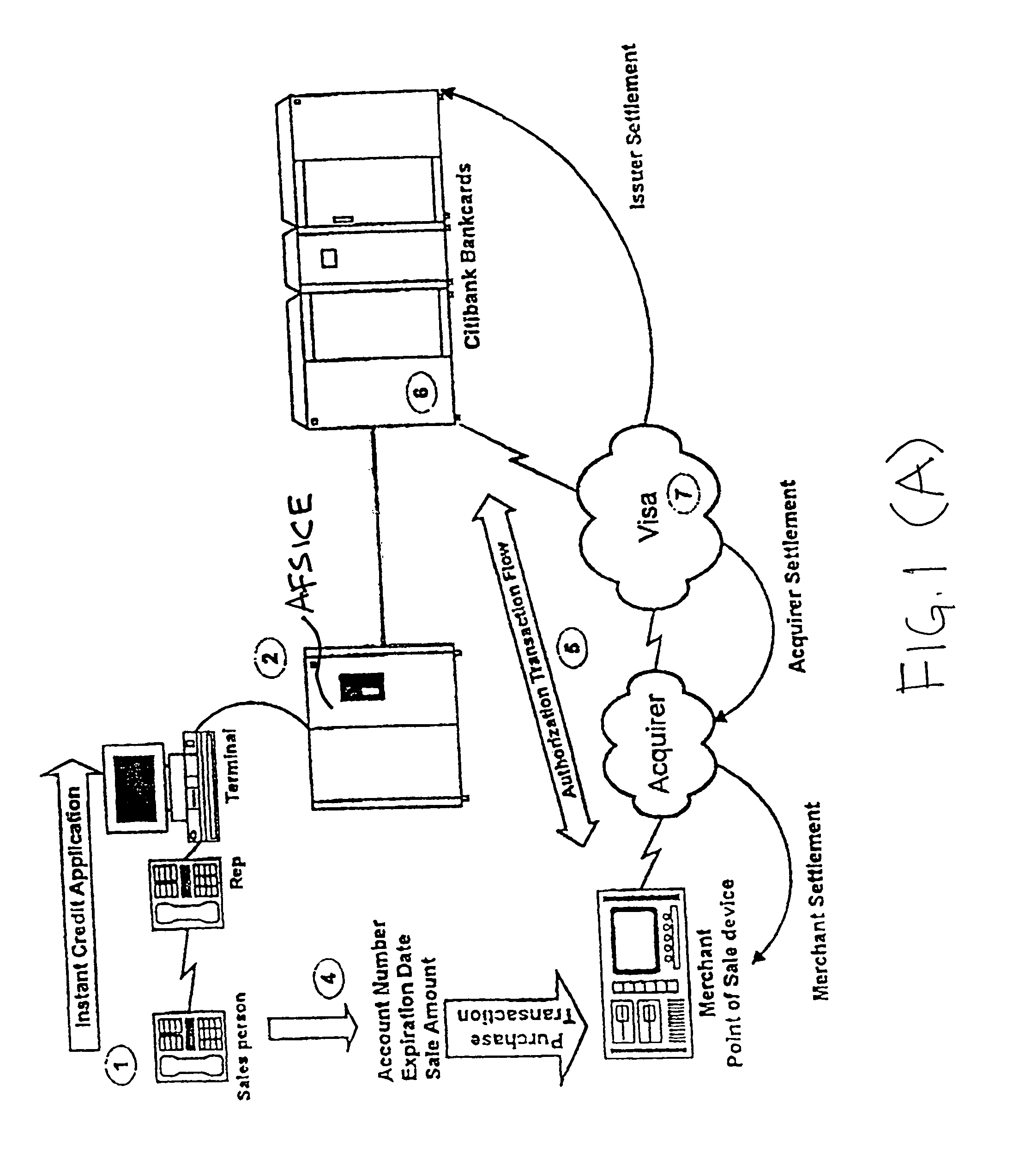

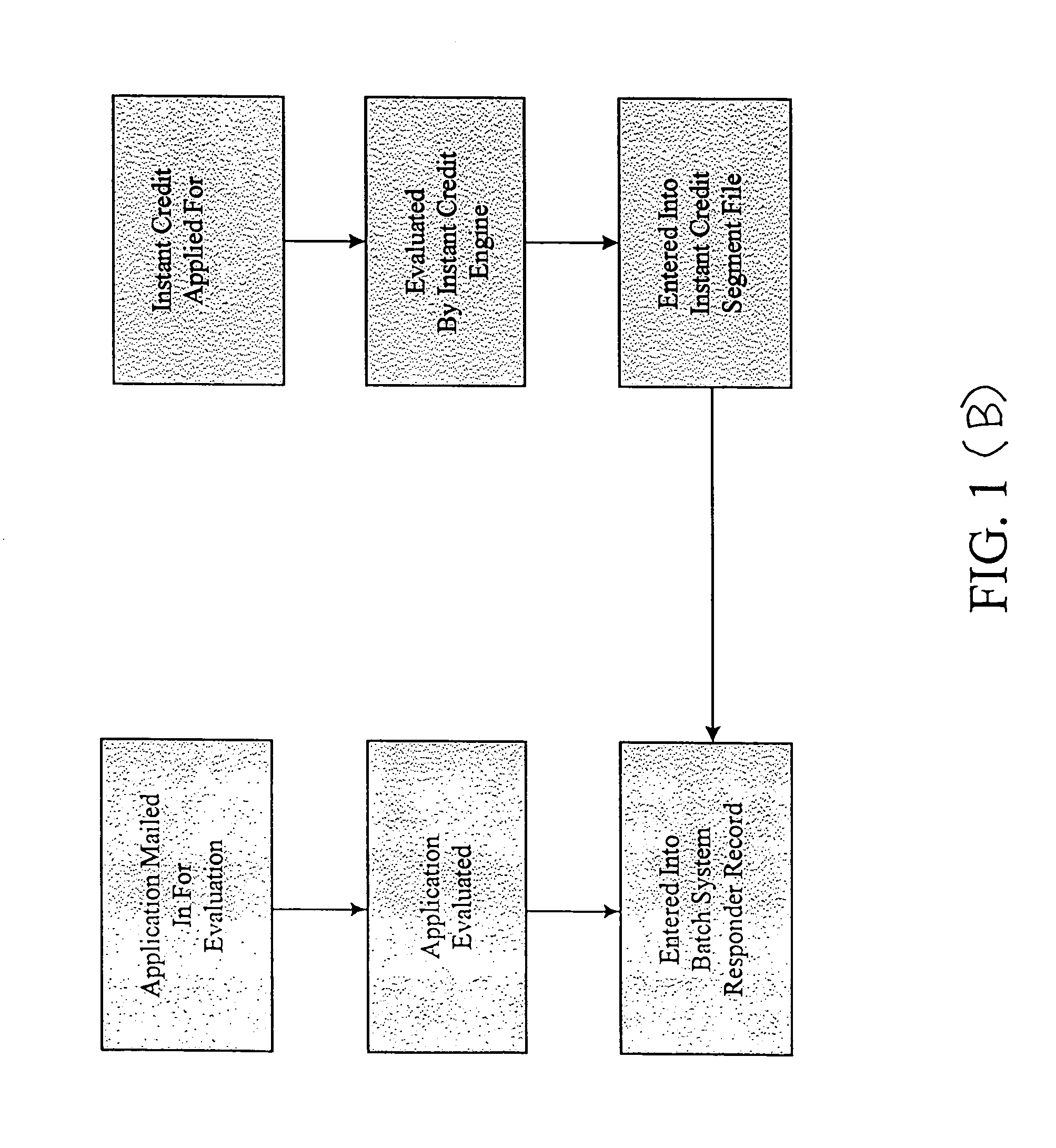

Method and system for the issuance of instant credit

A method and system for the issuance of Instant Credit has an Instant Credit engine that performs instantaneous analyses. The method and system can operate along side existing “batch” processes. In addition, the method and system offer various channels of distribution for the Instant Credit products. With the present invention, Instant Credit and other Instant services (e.g., instant account balance transfers, etc.) can be obtained via, Internet, point-of-sale and other distribution channels. The present system also enables highly dynamic product offerings, which can be generated “instantaneously” based on a variety of factors, such as, for example, the channels of distribution (e.g., telephone or Internet), the product sought and / or even the particular individual and / or entity that is applying for a line of credit.

Owner:CITIBANK

Systems and methods for obtaining financial offers using mobile image capture

Systems and methods for applying for and creating balance transfers with a mobile device are provided. An image of a customer's financial statement can be taken using a mobile device, after which the image is analyzed to extract information relevant to creating a balance transfer. The extracted information is then communicated to a bank over a network connected with the mobile device, where the bank can process the information and create an offer to the customer for a balance transfer in real-time. An example financial statement is a credit card statement. These systems and methods may comprise capturing an image of a document using a mobile communication device; transmitting the image to a server; detecting relevant information within the image; transmitting the information to a bank; and transmitting a resulting balance transfer offer from the bank to the mobile device.

Owner:MITEK SYST

Method and system for the issuance of instant credit

A method and system for the issuance of Instant Credit has an Instant Credit engine that performs instantaneous analysis. The method and system can operate along side existing “batch” processes. In addition, the method and system offer various channels of distribution for the Instant Credit products. With the present invention, Instant Credit and other Instant services (e.g., instant account balance transfers, etc.) can be obtained via, Internet, point-of-sale and other distribution channels. The present system also enables highly dynamic product offerings, which can be generated “instantaneously” based on a variety of factors, such as, for example, the channels of distribution (e.g., telephone or Internet), the product sought and / or even the particular individual and / or entity that is applying for a line of credit.

Owner:CITIBANK

System for Cash, Expense And Withdrawal Allocation Across Assets and Liabilities to Maximize Net Worth Over a Specified Period

This invention constitutes a method for taking a set of input parameters specifying a person or family's assets, liabilities, income and expenses and computing the optimal amount of cash to withdrawal from each credit source or asset (including liquidation of physical assets, credit card balance transfers, and use of loan sources) and the allocation of expenses and cash flow across assets and liabilities so as to maximize net worth by a particular date. The method consists of computing marginal and average expense and return functions for each asset and liability to do a no-withdrawal monthly optimization from the start month to the target month on which to maximize net worth, then recursively computing optimal withdrawal amounts for each source of capital on specific months, ultimately finding the optimal withdrawal amount for each source on each of these months and returning the optimal allocation of expenses and the resulting income and cash-flow across assets and liabilities. This invention is being applied to an online environment, where the user inputs the necessary details and optimization takes place on the server.

Owner:ROBERTSON MICHAEL PAUL

User interfaces for managing an account

ActiveUS20200302519A1Faster and efficient method and interfaceReduce cognitive loadDatabase queryingFinanceBalance transferEngineering

In some embodiments, exemplary user interfaces for provisioning an electronic device with an account are described. In some embodiments, exemplary user interfaces for providing usage information of an account are described. In some embodiments, exemplary user interfaces for providing visual feedback on a representation of an account are described. In some embodiments, exemplary user interfaces for managing the tracking of a category are described. In some embodiments, exemplary user interfaces for managing a transfer of items are described. In some embodiments, exemplary user interfaces for managing an authentication credential connected with an account are described. In some embodiments, exemplary user interfaces for activating a physical account object are described. In some embodiments, exemplary user interfaces for managing balance transfers are described.

Owner:APPLE INC

User interfaces for managing an account

ActiveUS20200302517A1Faster and efficient method and interfaceReduce cognitive loadDatabase queryingFinanceBalance transferEngineering

In some embodiments, exemplary user interfaces for provisioning an electronic device with an account are described. In some embodiments, exemplary user interfaces for providing usage information of an account are described. In some embodiments, exemplary user interfaces for providing visual feedback on a representation of an account are described. In some embodiments, exemplary user interfaces for managing the tracking of a category are described. In some embodiments, exemplary user interfaces for managing a transfer of items are described. In some embodiments, exemplary user interfaces for managing an authentication credential connected with an account are described. In some embodiments, exemplary user interfaces for activating a physical account object are described. In some embodiments, exemplary user interfaces for managing balance transfers are described.

Owner:APPLE INC

Reducing risks related to check verification

ActiveUS8543499B2Efficient use ofEfficient managementFinancePayment architectureLower riskBalance transfer

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

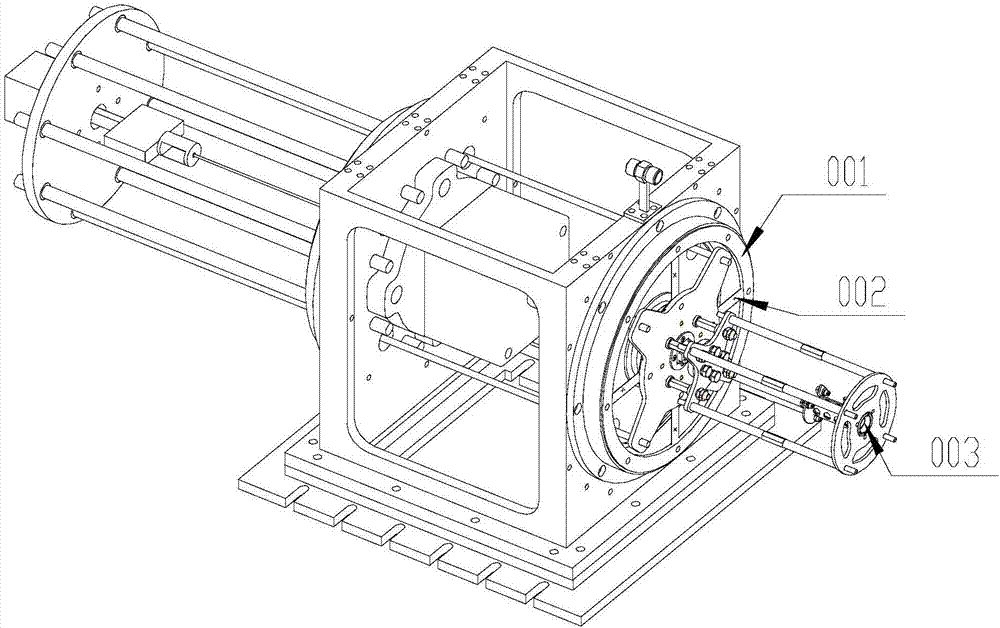

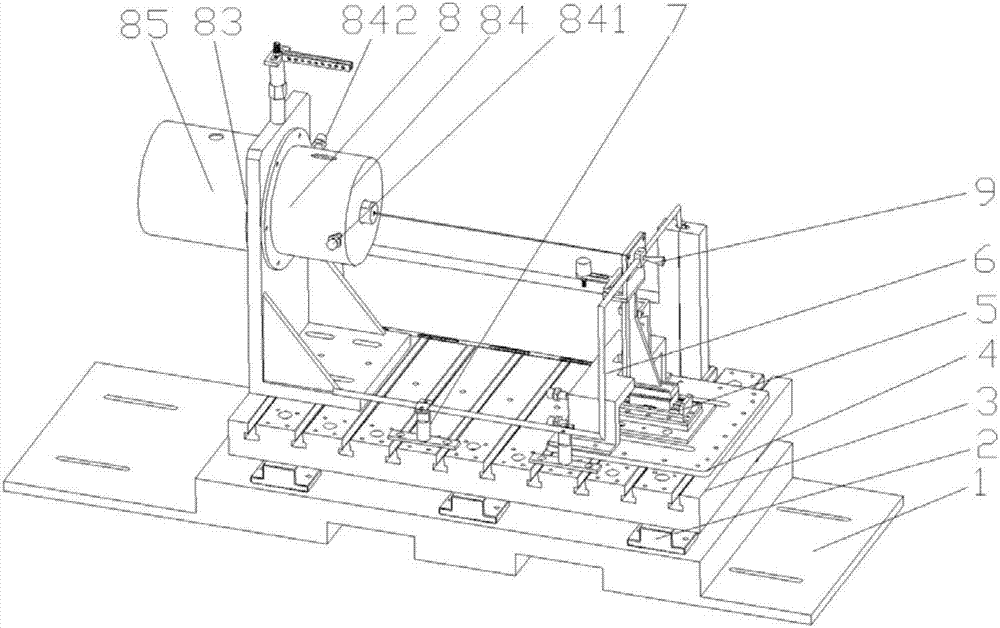

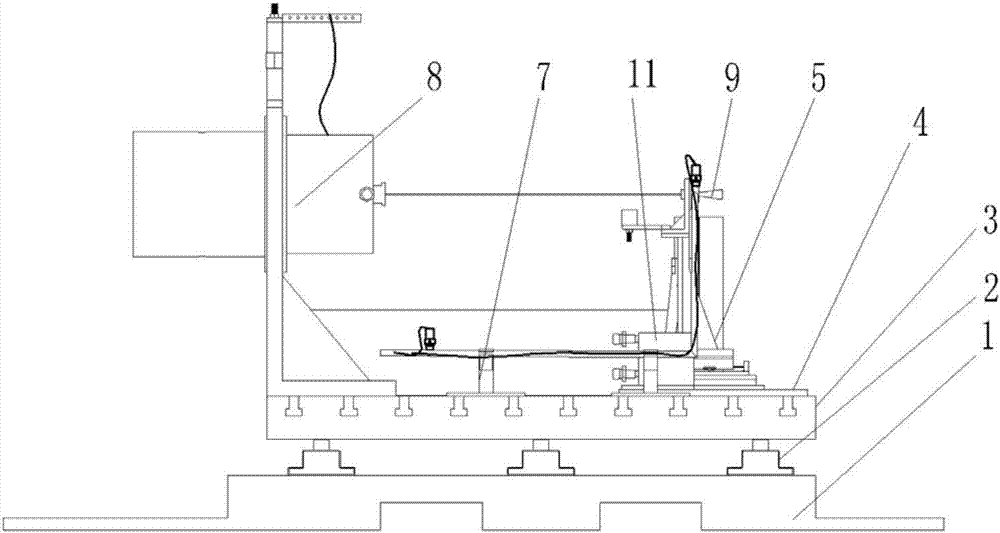

Calibration measurement device for steady-state thrust of 4-25N attitude control engine in thermal vacuum environment

ActiveCN107202660ASolve the problem of many uncertaintiesImprove calibration accuracyApparatus for force/torque/work measurementForce/torque/work measurement apparatus calibration/testingMeasurement deviceBalance transfer

The invention relates to a calibration measurement device for steady-state thrust of a 4-25N attitude control engine in a thermal vacuum environment. The calibration measurement device comprises a base transfer frame, shock absorbing blocks, a fixed frame, a balance transfer plate, a single-component balance measurement device, a propellant pipeline, propellant pipeline fixing devices and an in-situ calibration device, wherein the shock absorbing blocks are uniformly mounted between the base transfer frame and the fixed frame; the propellant pipeline fixing devices are fixedly mounted on the periphery of the fixed frame; the propellant pipeline is mounted through the propellant pipeline fixing devices, one end of the propellant pipeline is communicated with an external propellant supply system, and the other end of the propellant pipeline is communicated with a propellant inlet of a to-be-measured attitude control engine; the single-component balance measurement device is mounted at one end of the fixed frame through the balance transfer plate, and the in-situ calibration device is mounted at the other end of the fixed frame. The calibration measurement device meets the requirements of the 4-25N attitude control engine for low thrust calibration measurement and solves the problems that high uncertainty is caused by pipeline constraint, high temperature and vibration in a measurement process, calibration before test run is not proper, the calibration precision is poor and the like.

Owner:XIAN AEROSPACE PROPULSION TESTING TECHN INST

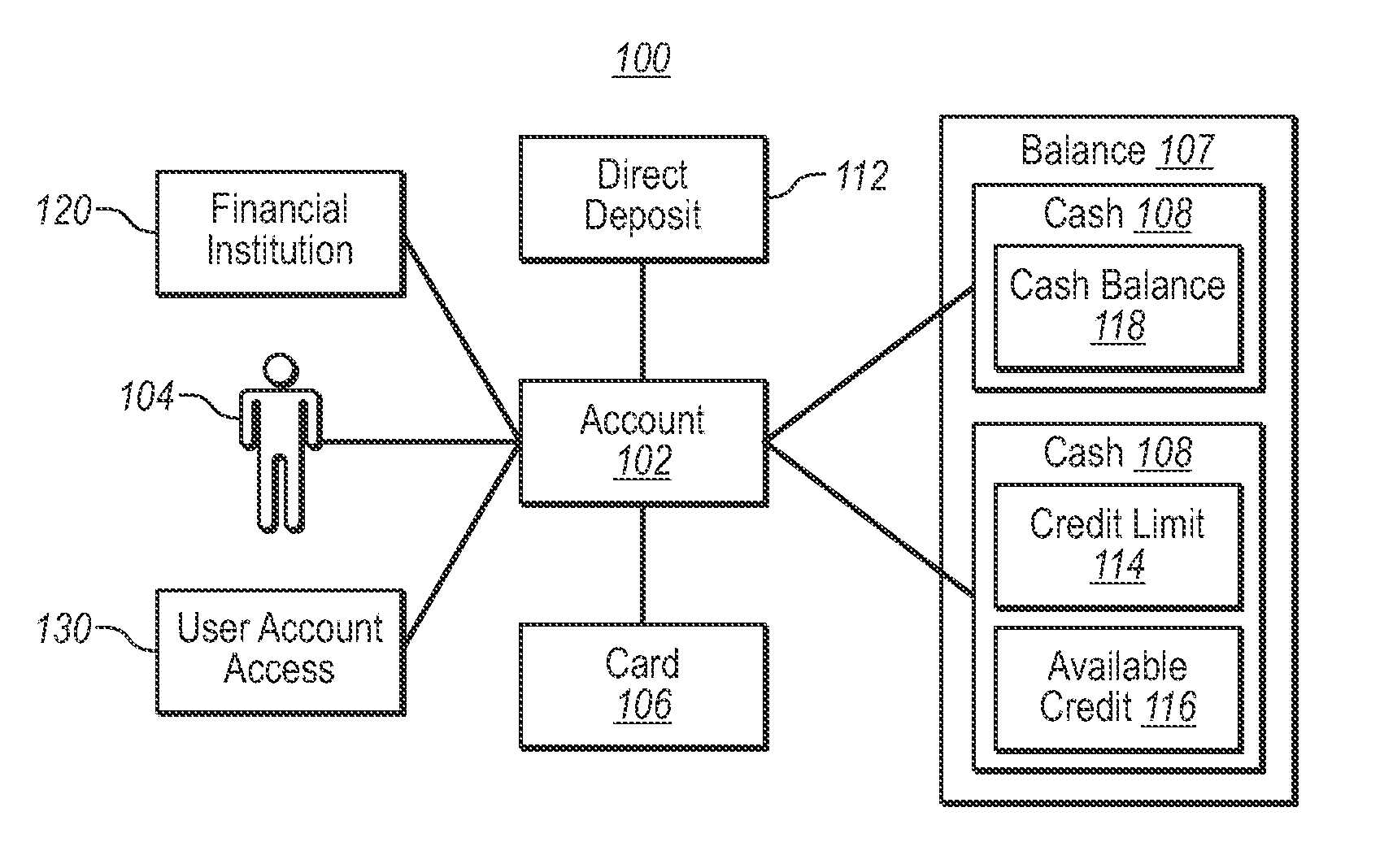

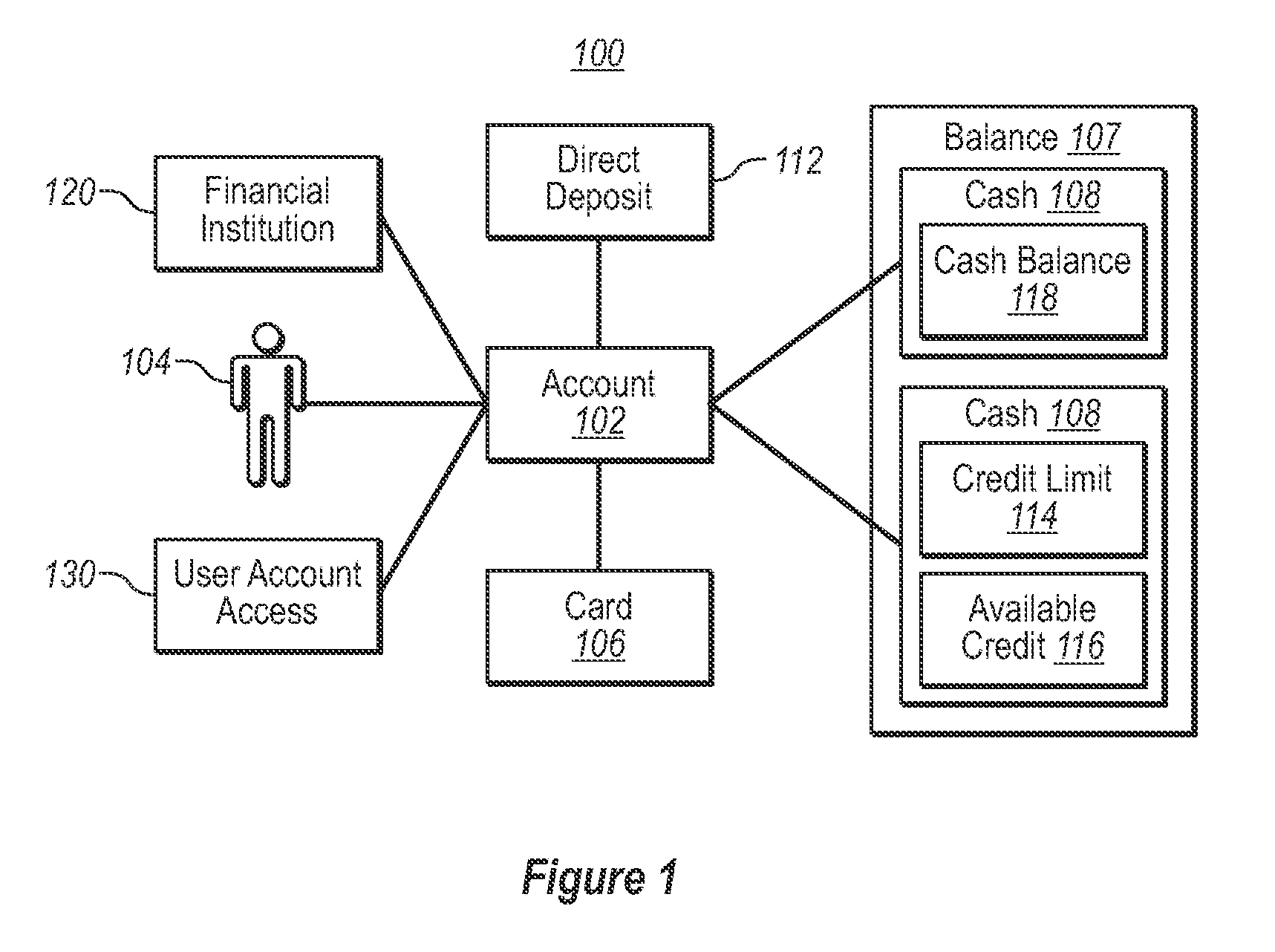

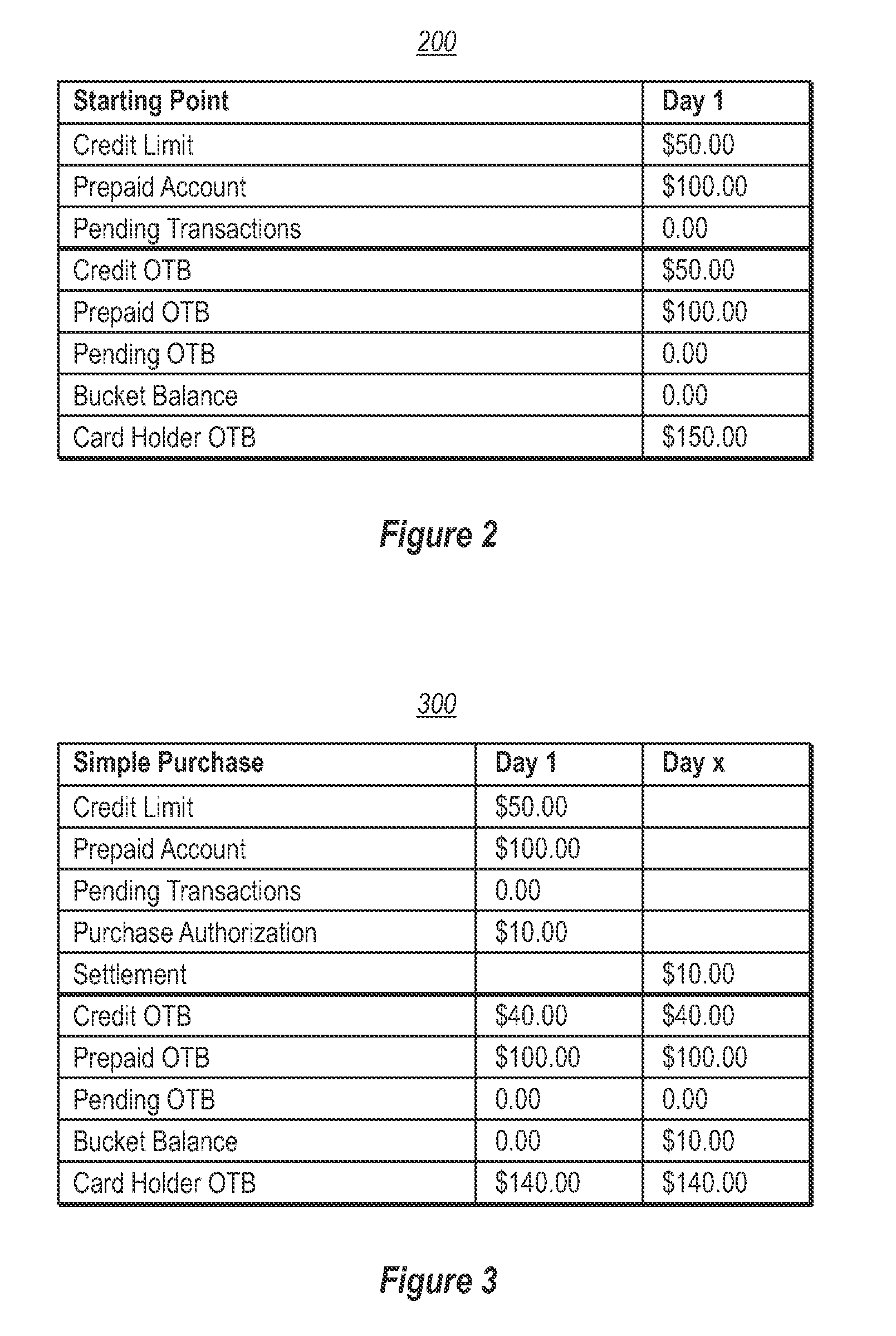

Financial instrument having credit and pre-paid characteristics

Embodiments of the present invention provide for methods and systems for providing a financial instrument that possesses both credit features (secured and unsecured) and prepaid features. When a purchase is made using a financial instrument linked to an account, funds are first drawn from a line of credit until a credit limit is reached. Any additional funds required to make the purchase are then drawn from a secured account, such as a prepaid cash balance. In some embodiments, the additional funds are automatically drawn form the prepaid cash balance while in other embodiments an account holder manually transfers funds from the prepaid cash balance to the credit balance.

Owner:GALILEO PROCESSING

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com