Patents

Literature

44 results about "Credit enhancement" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Credit enhancement is the improvement of the credit profile of a structured financial transaction or the methods used to improve the credit profiles of such products or transactions. It is a key part of the securitization transaction in structured finance, and is important for credit rating agencies when rating a securitization.

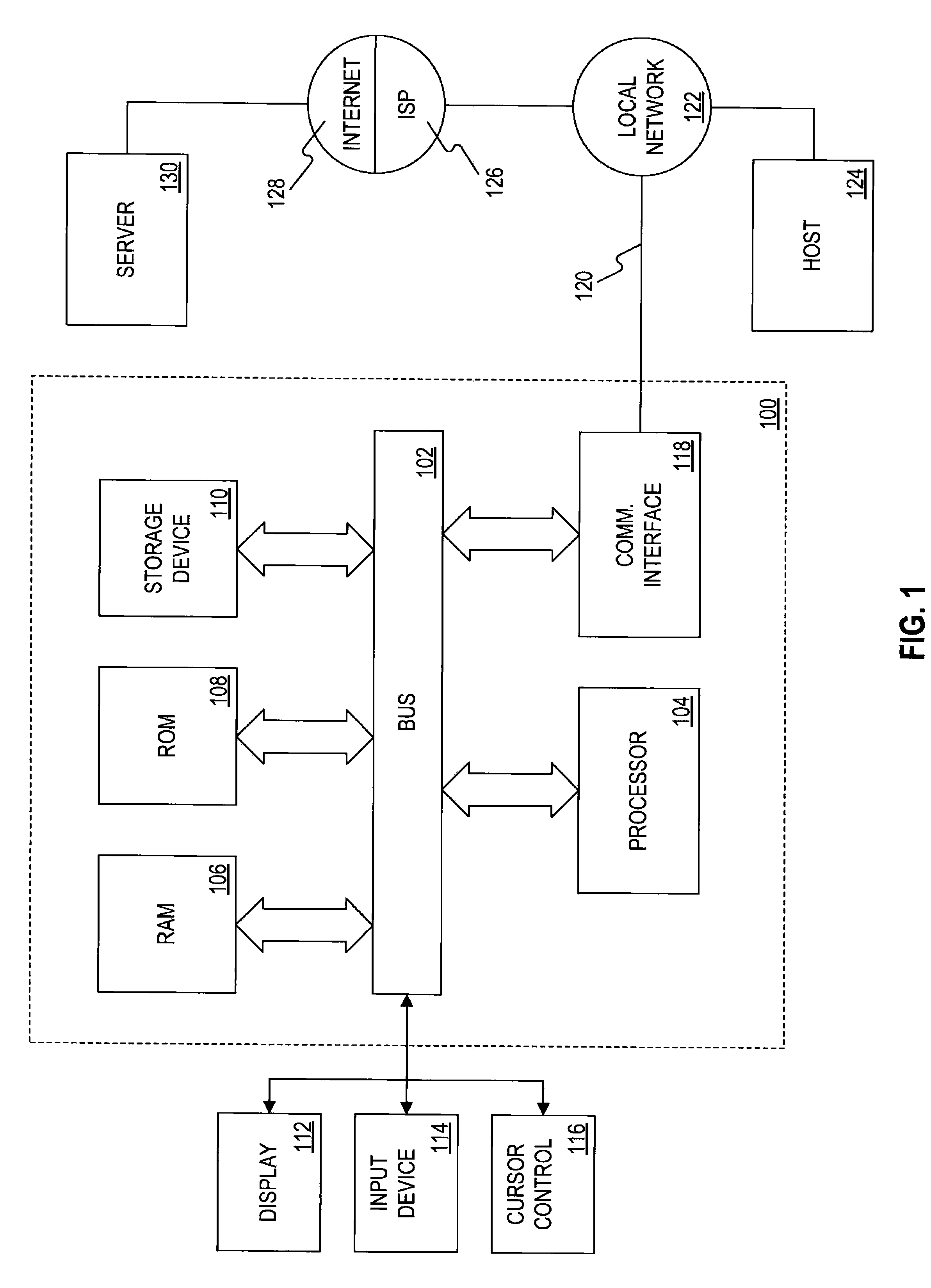

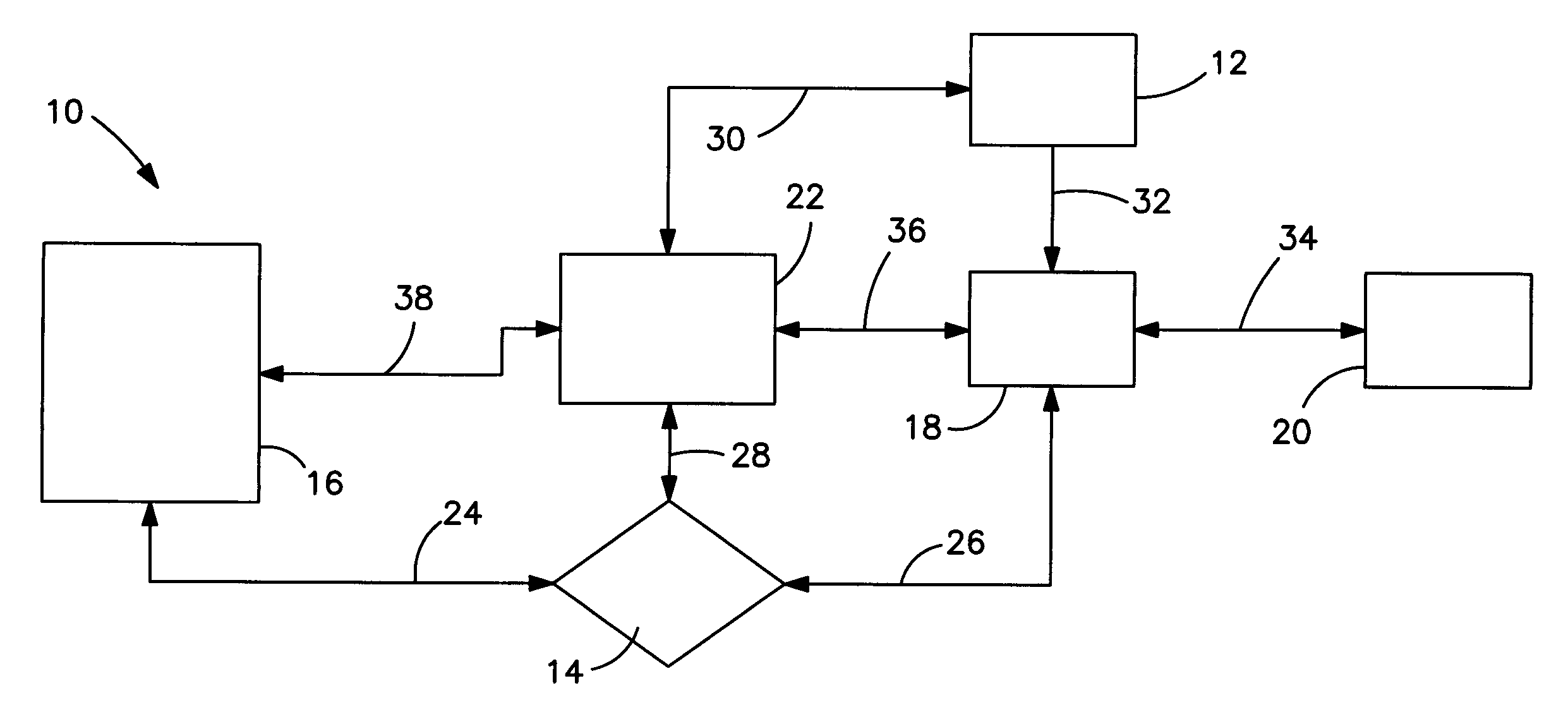

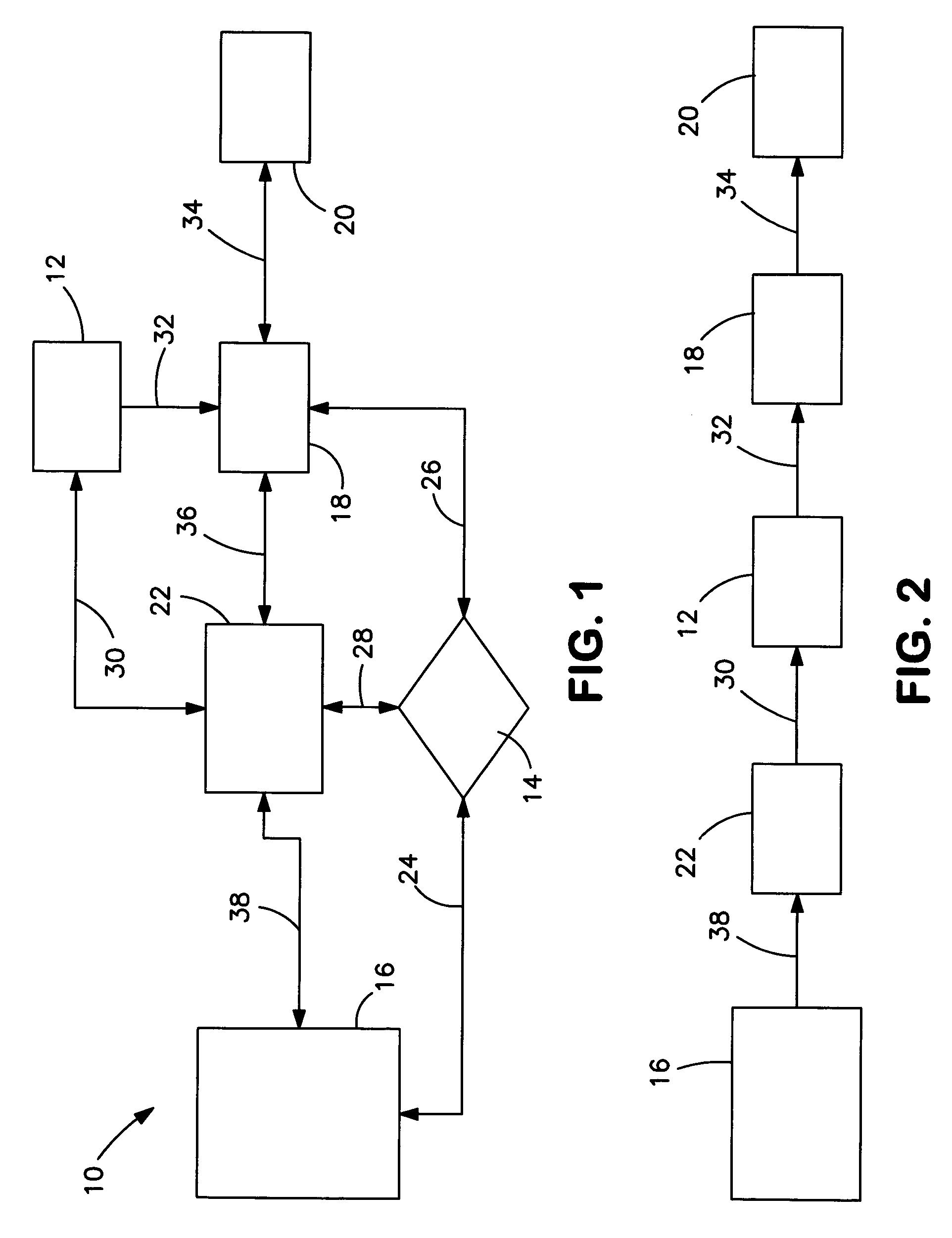

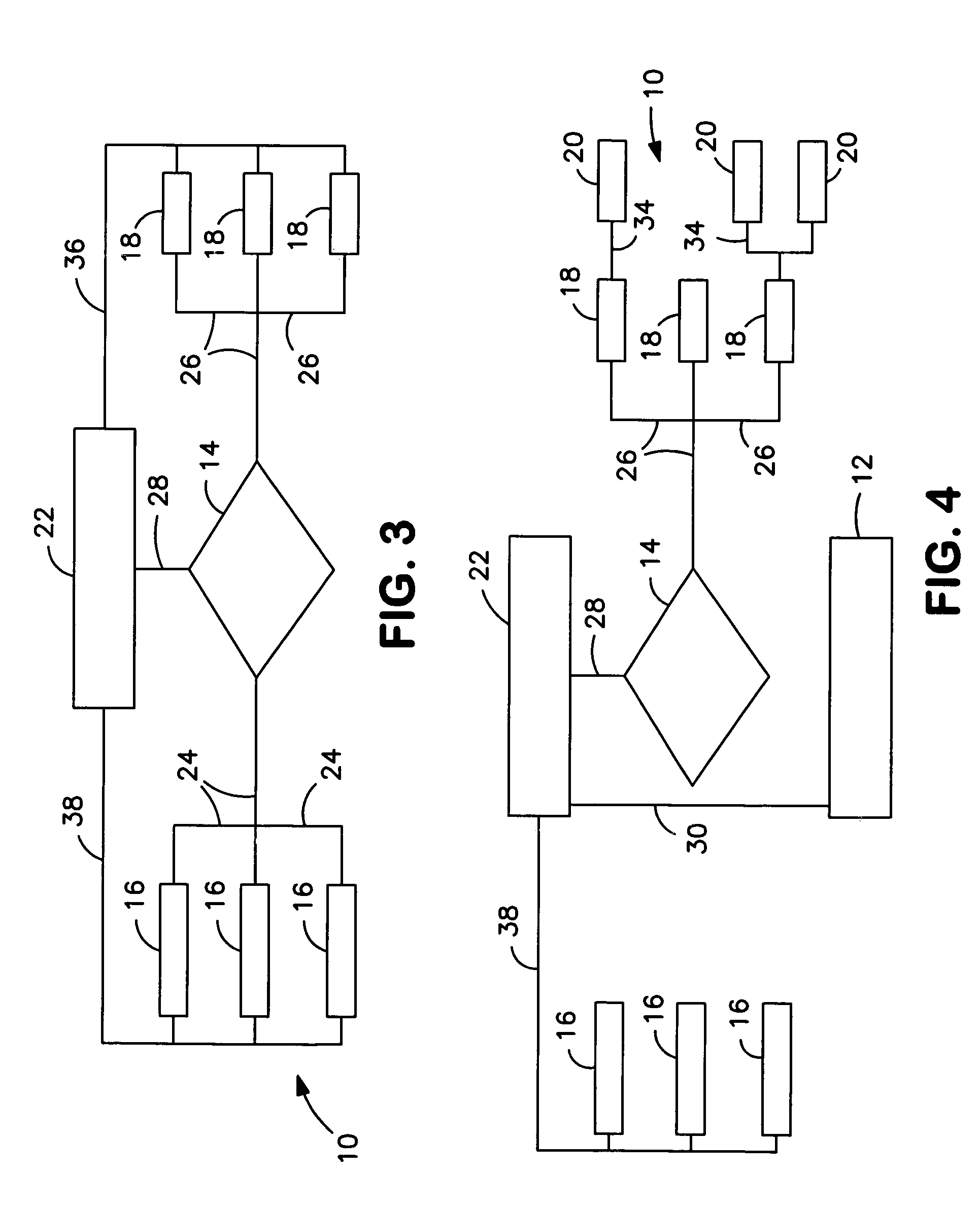

Method and apparatus for rating asset-backed securities

ActiveUS20060242047A1Efficient use ofEfficient managementFinanceInput/output processes for data processingBalance transferData source

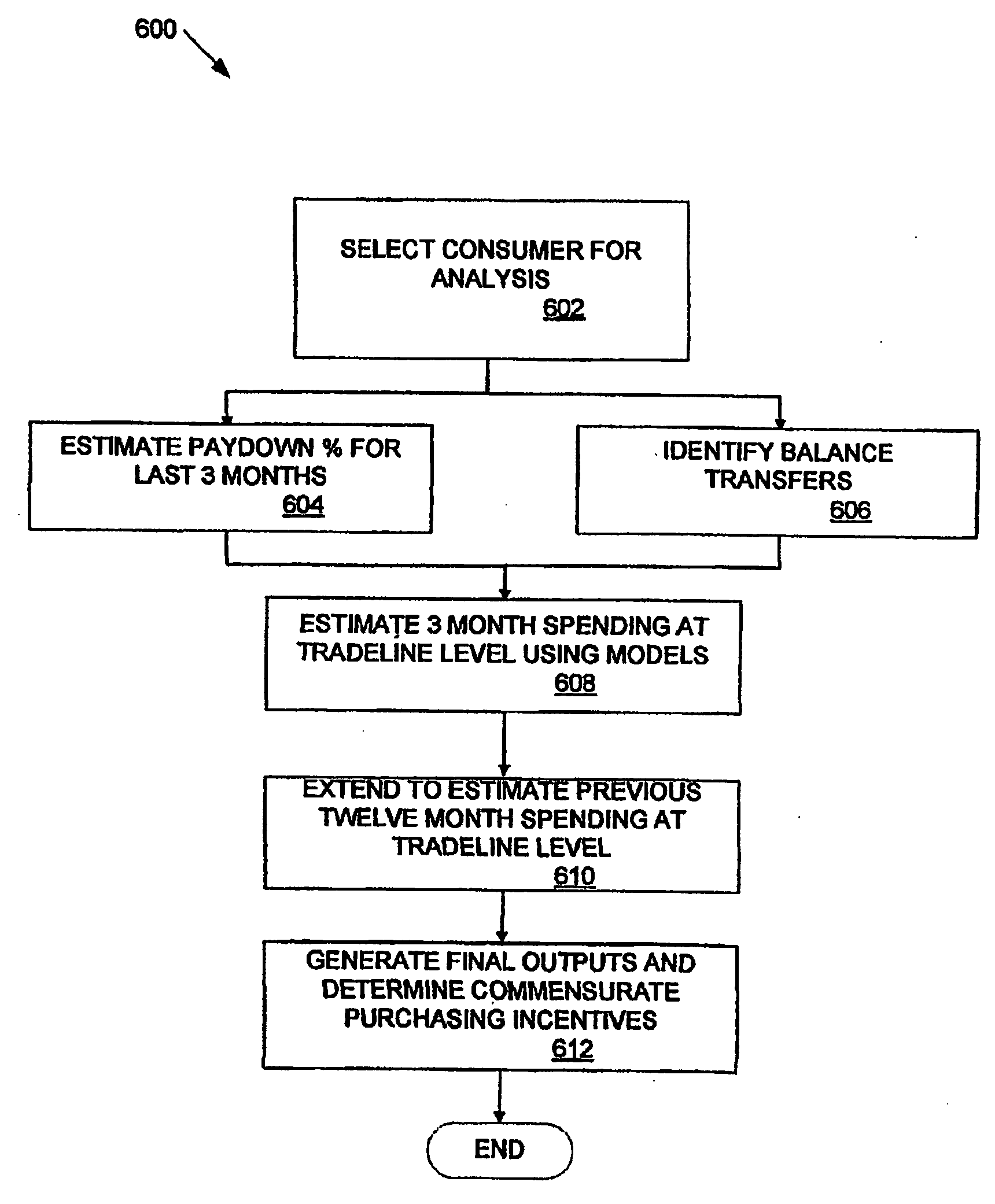

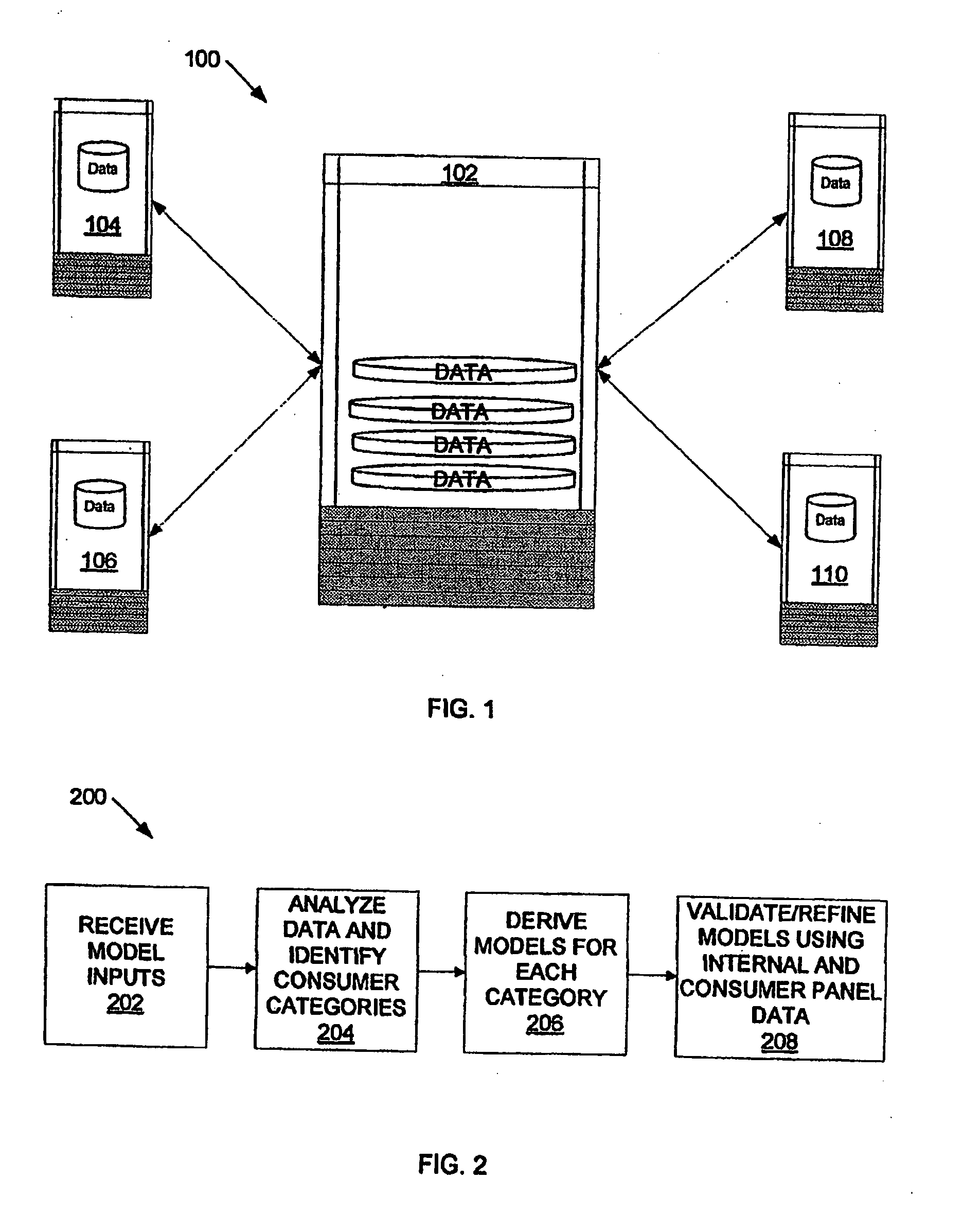

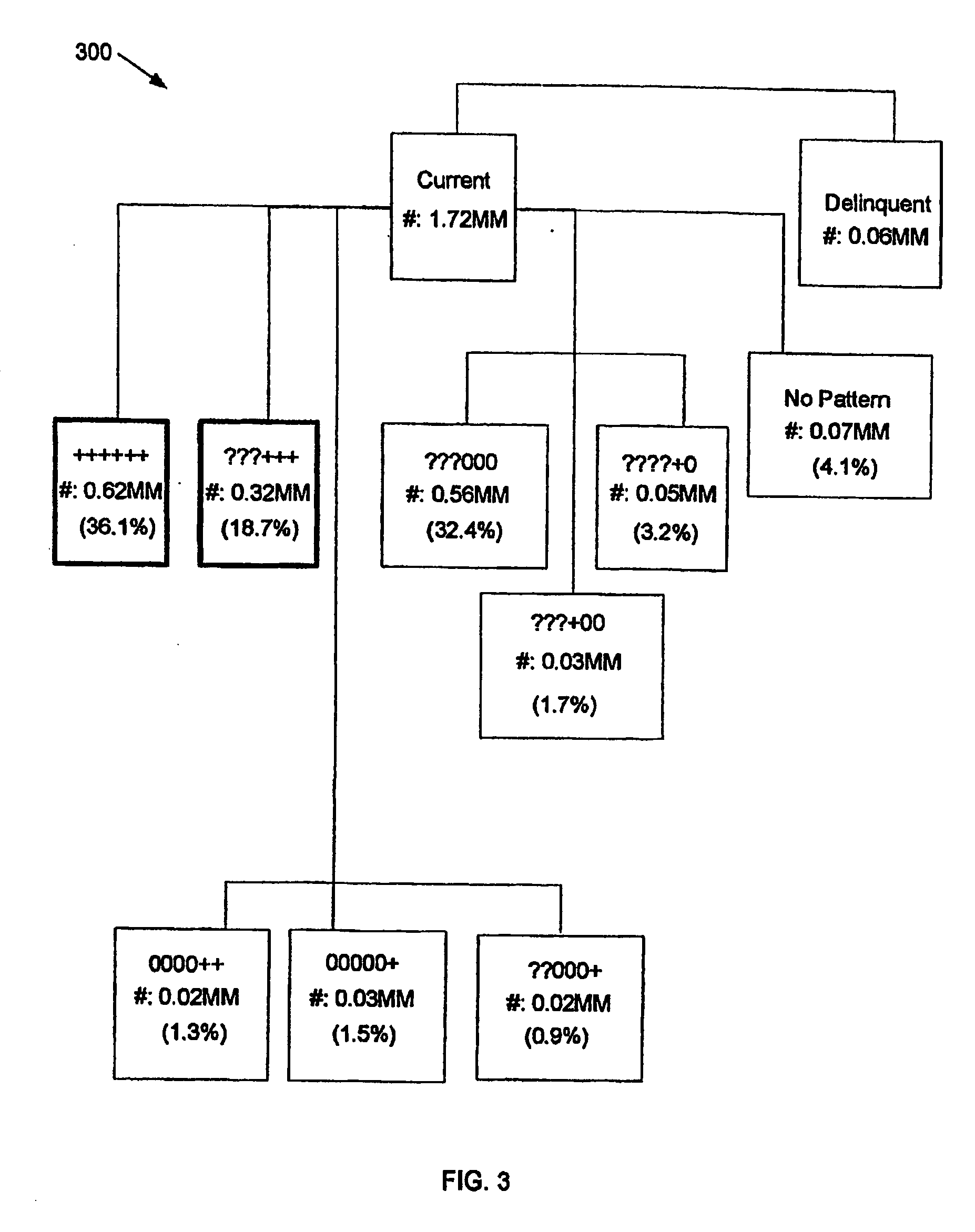

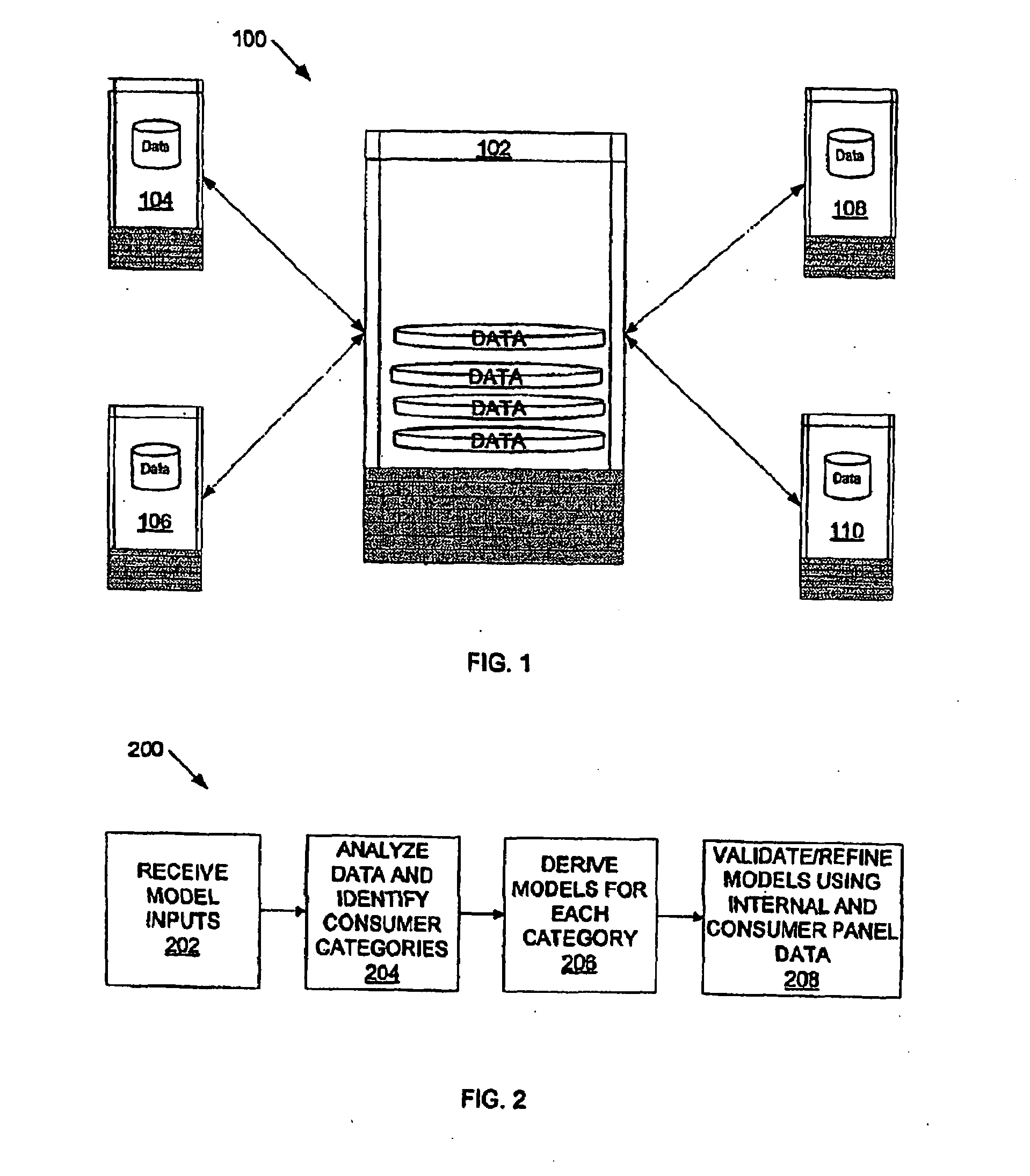

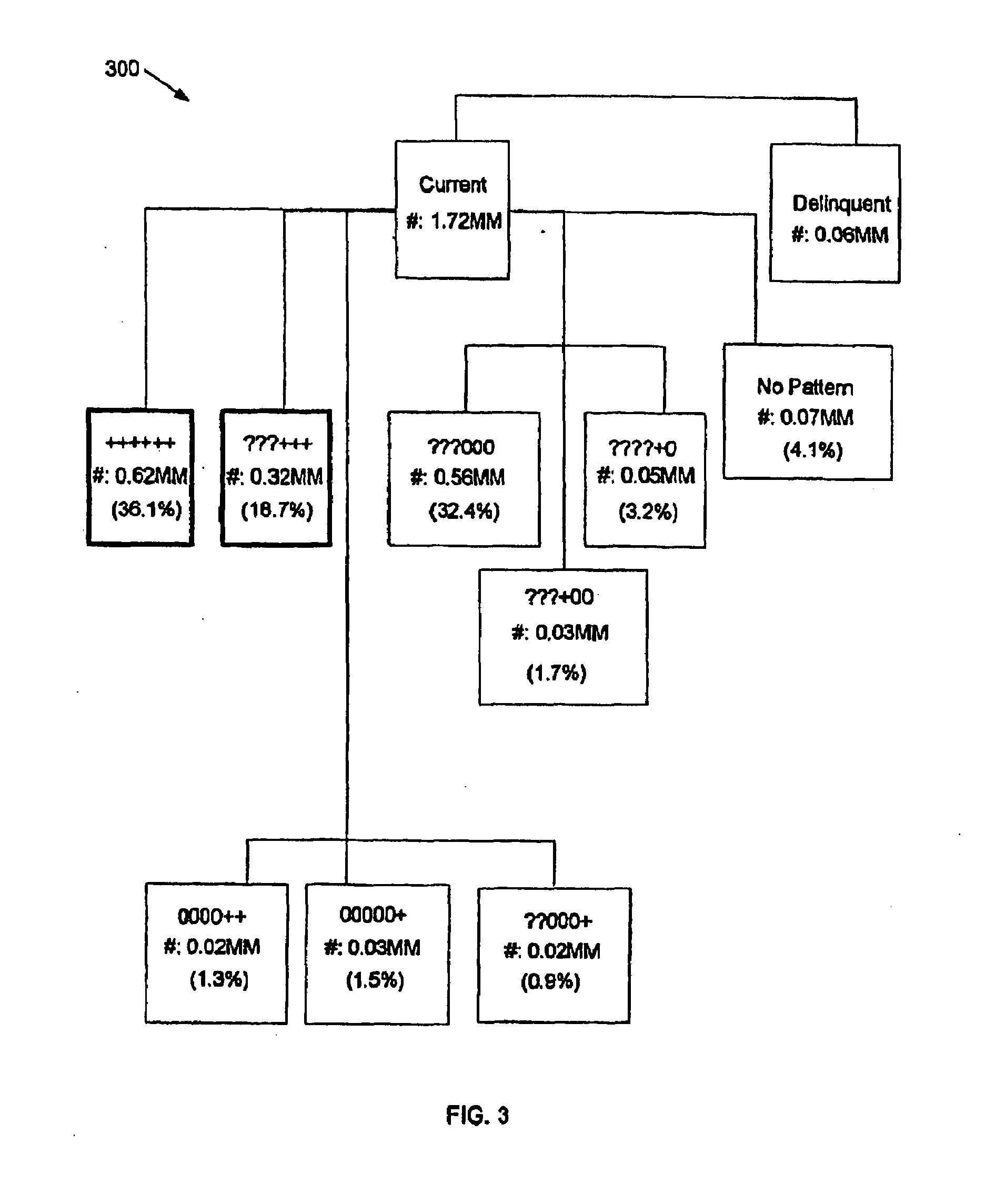

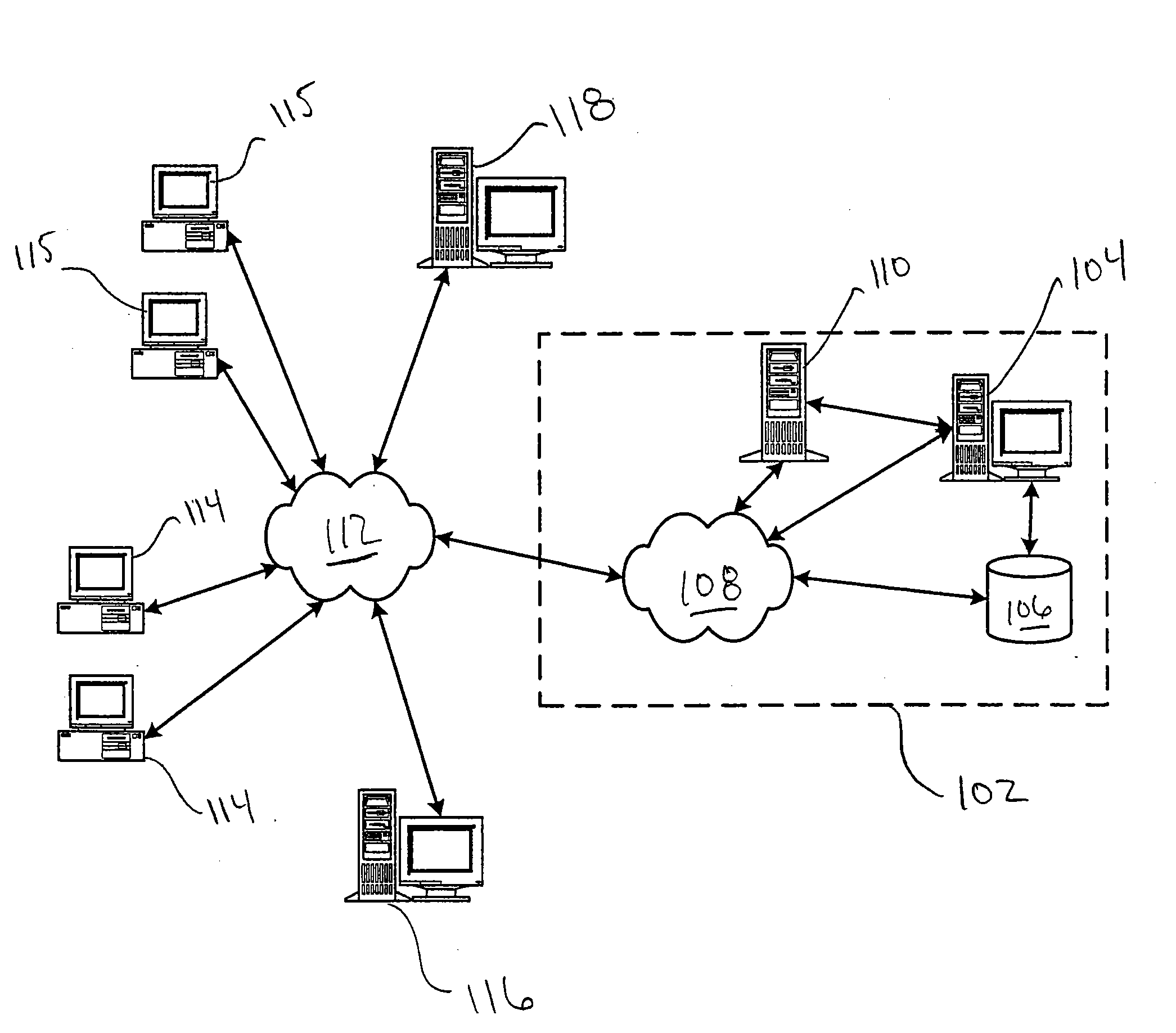

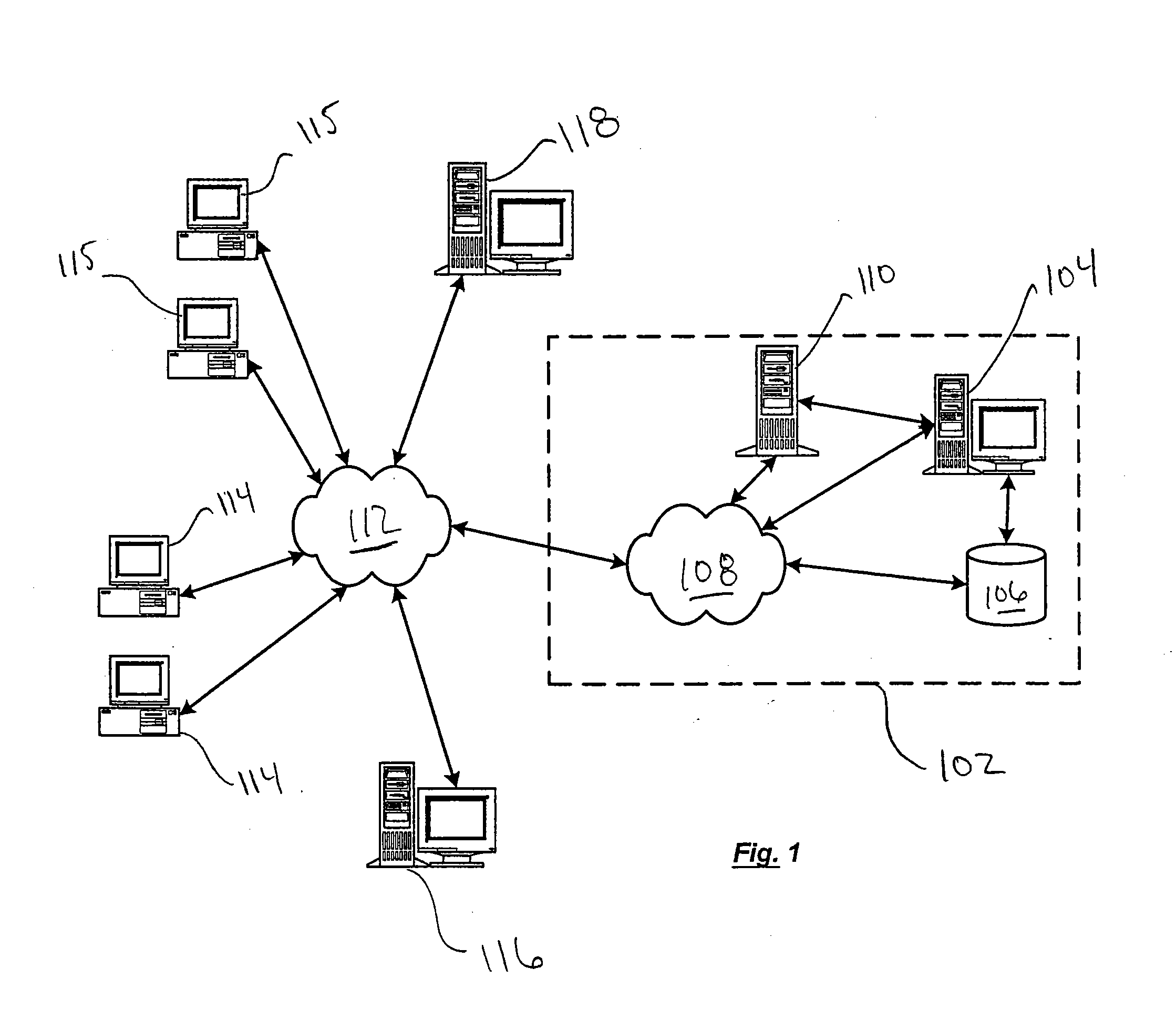

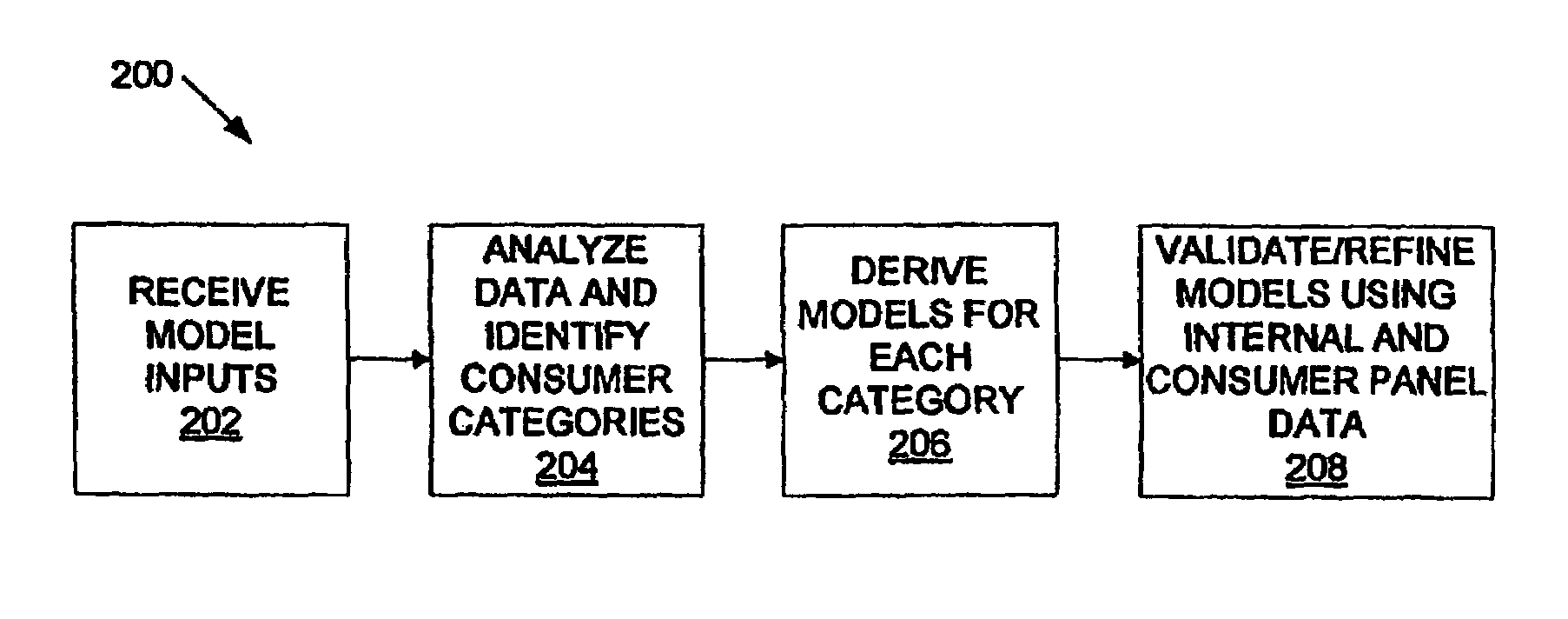

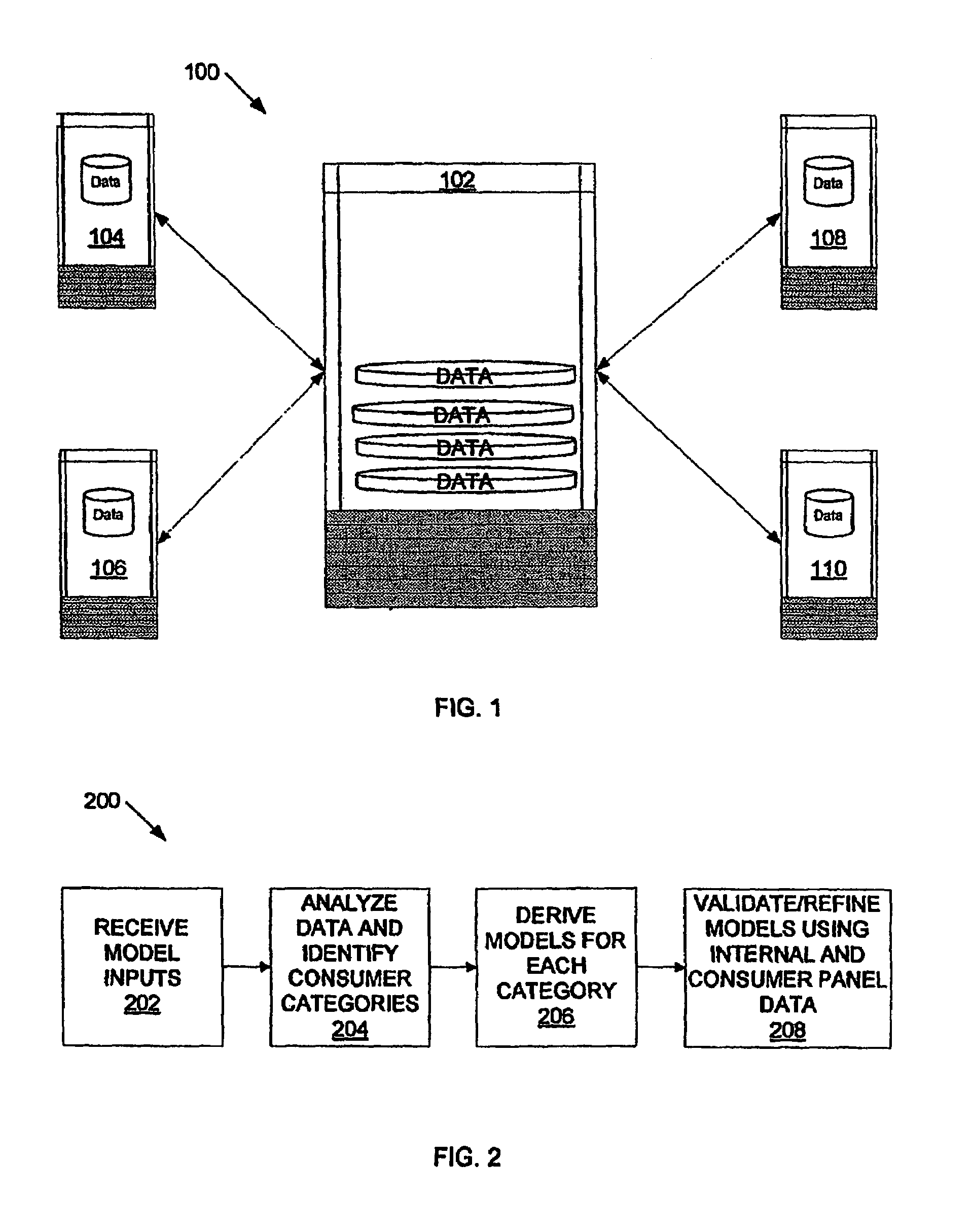

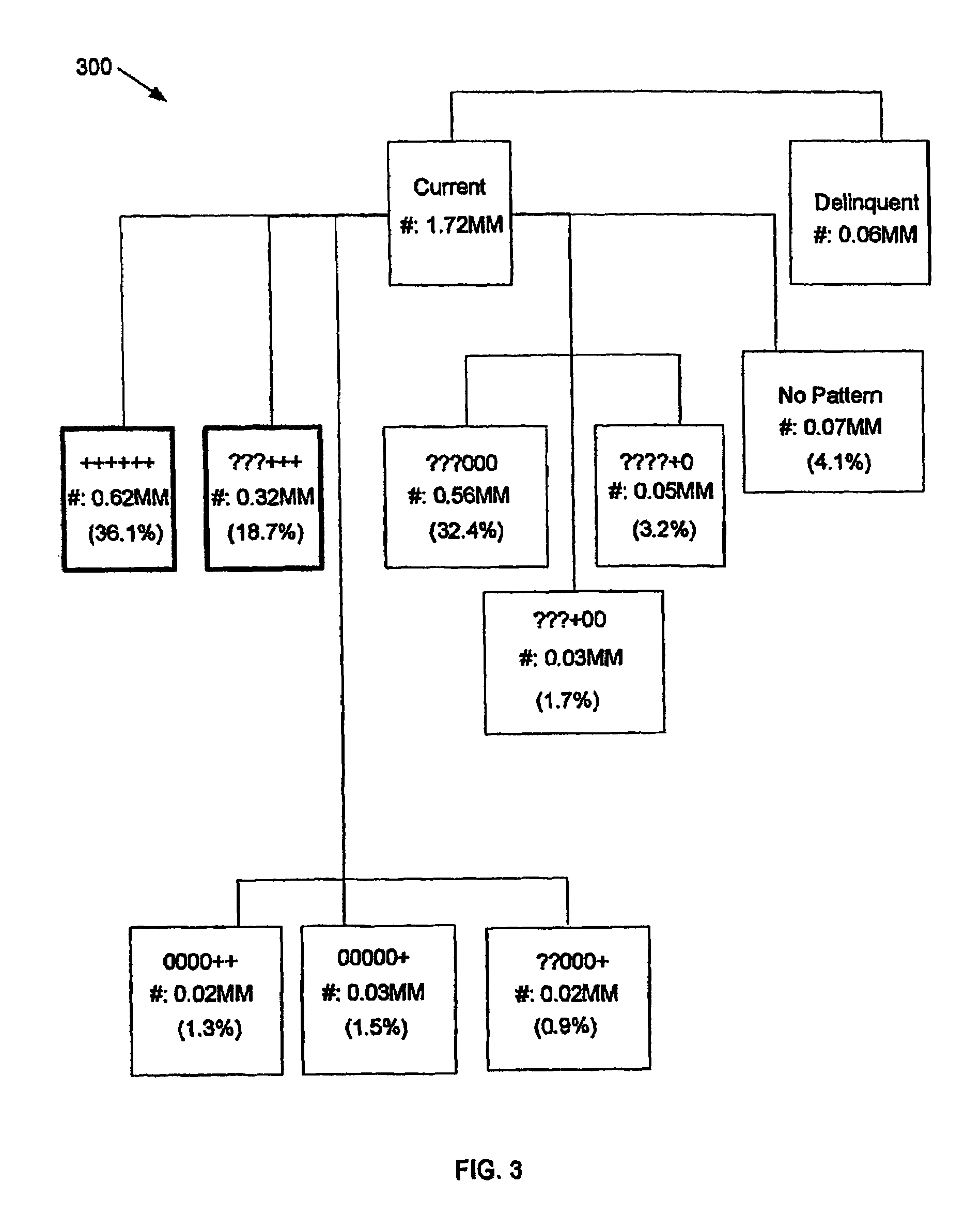

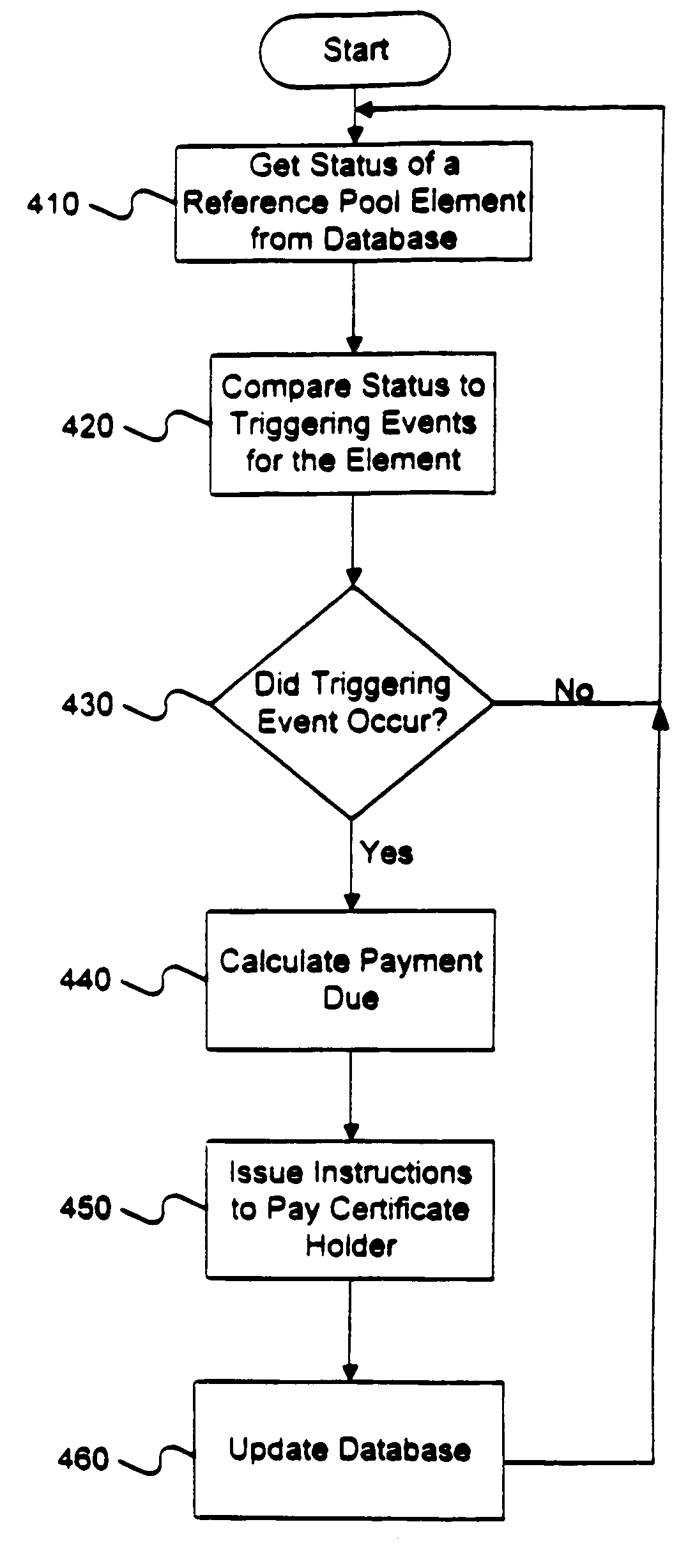

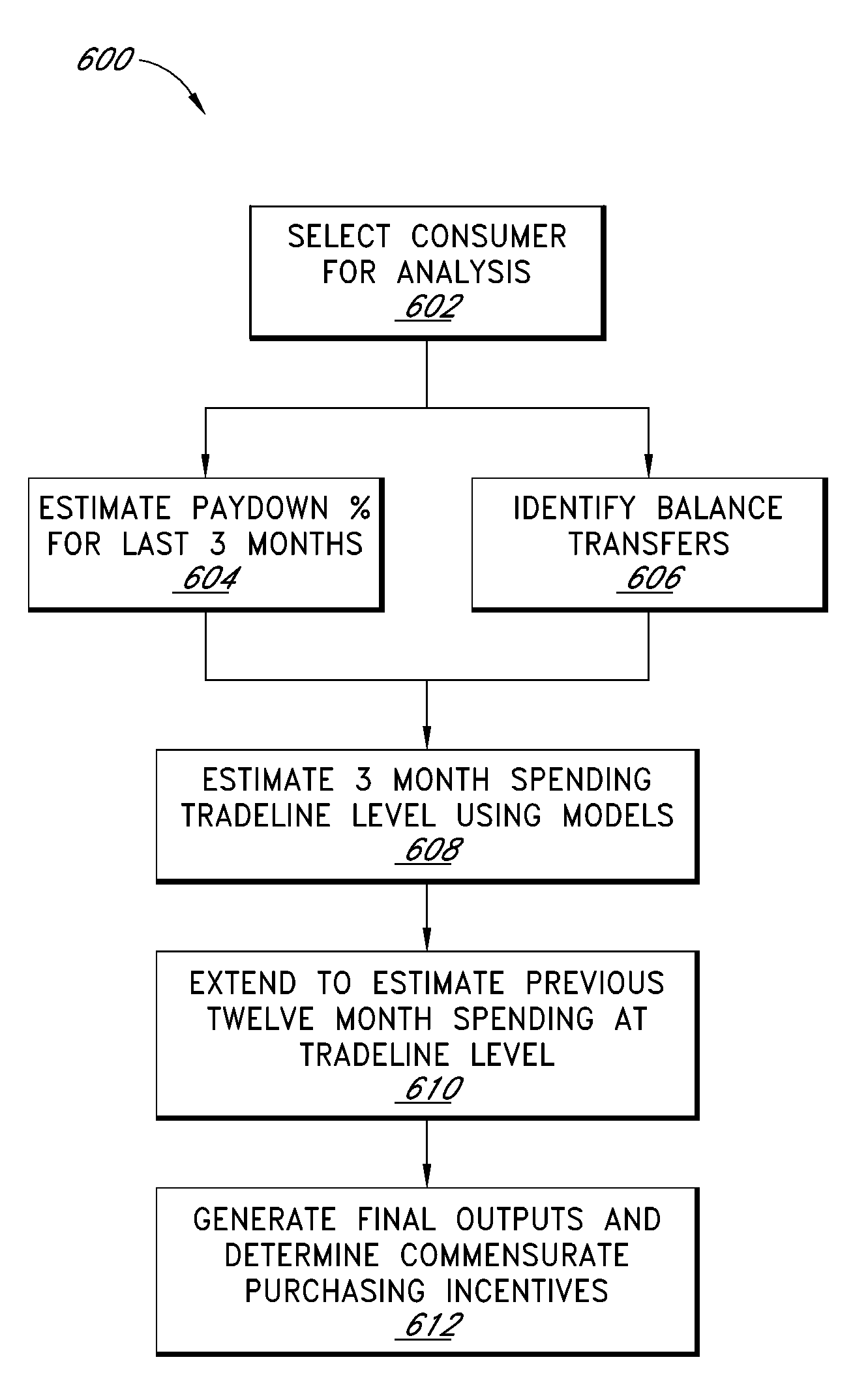

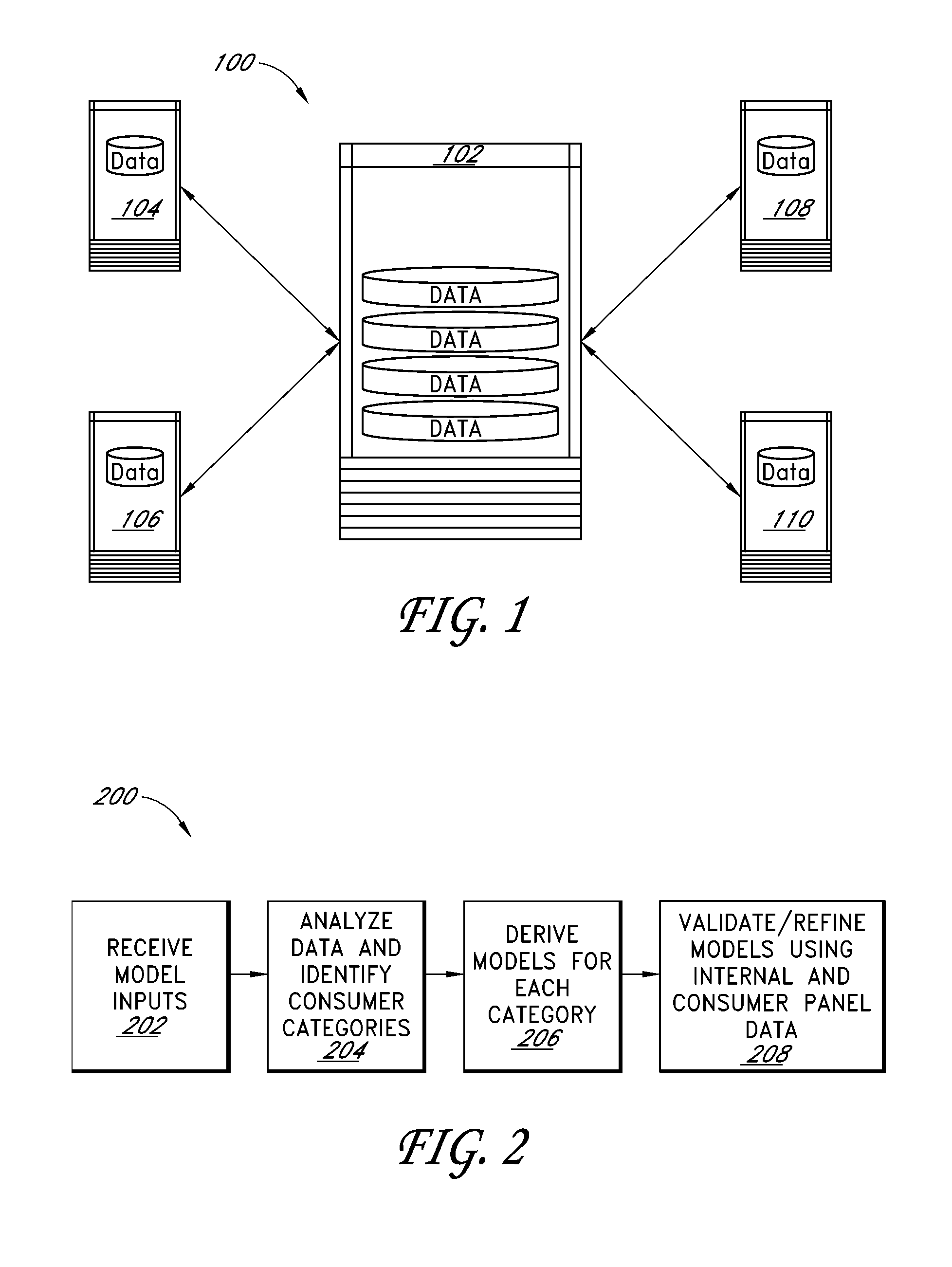

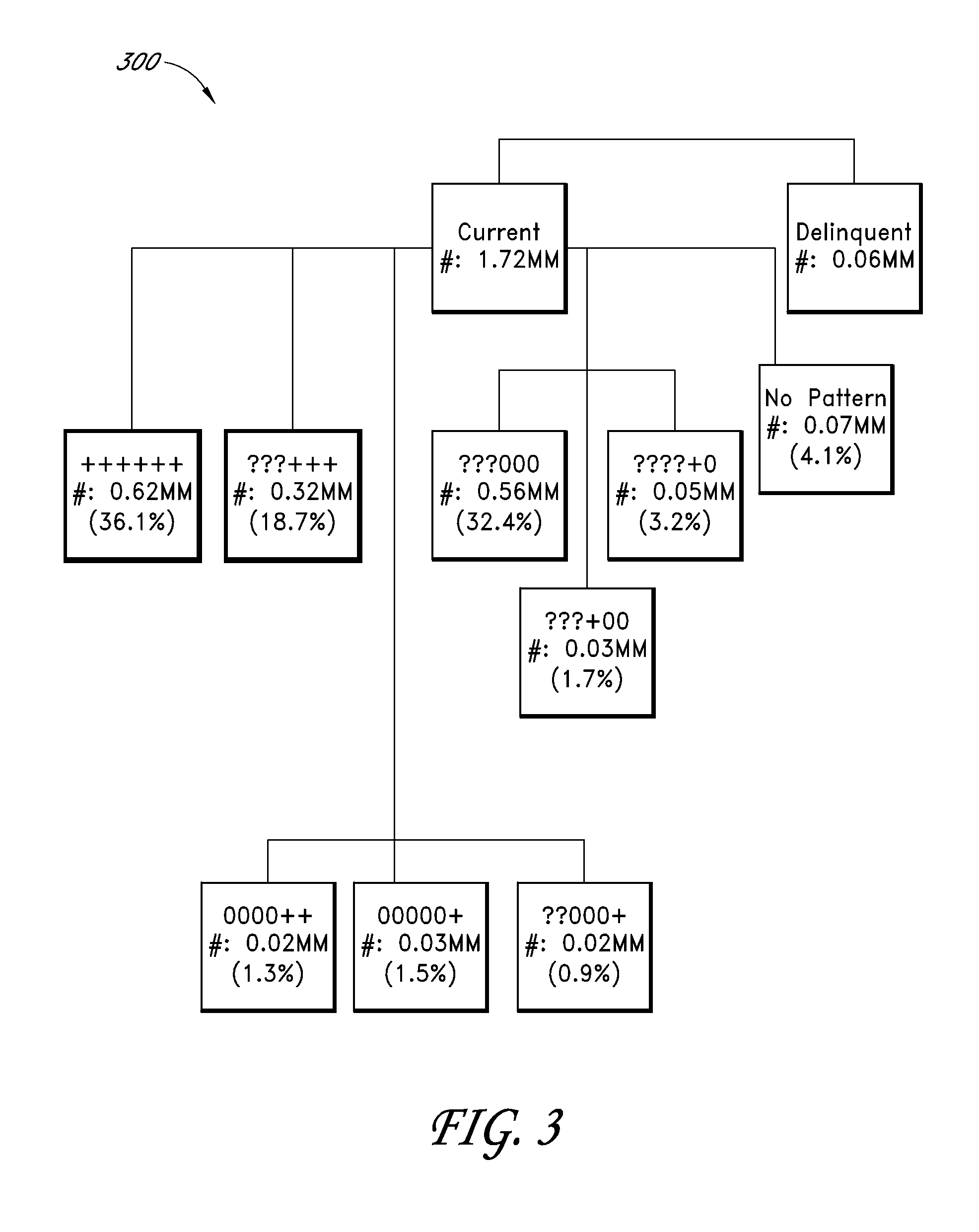

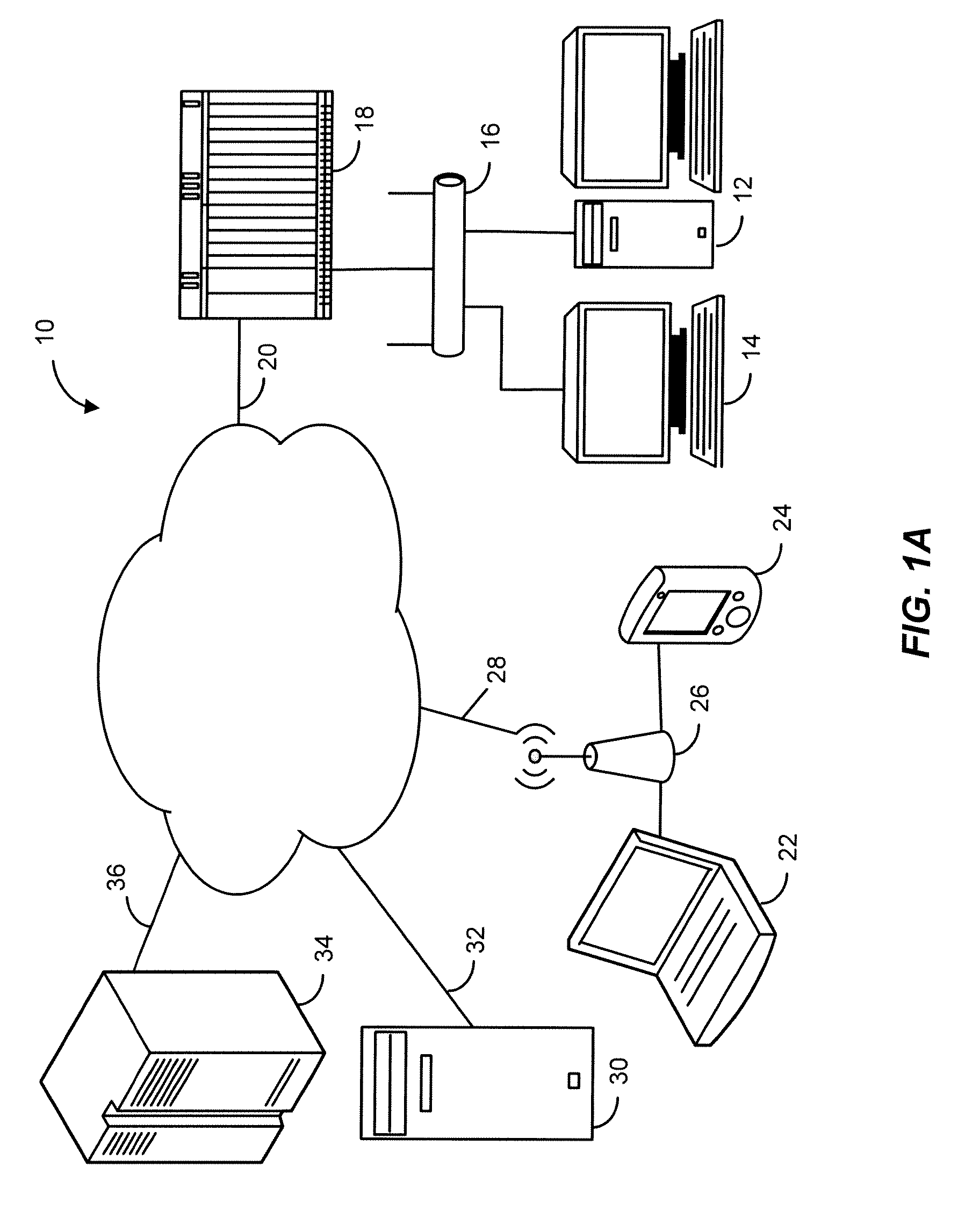

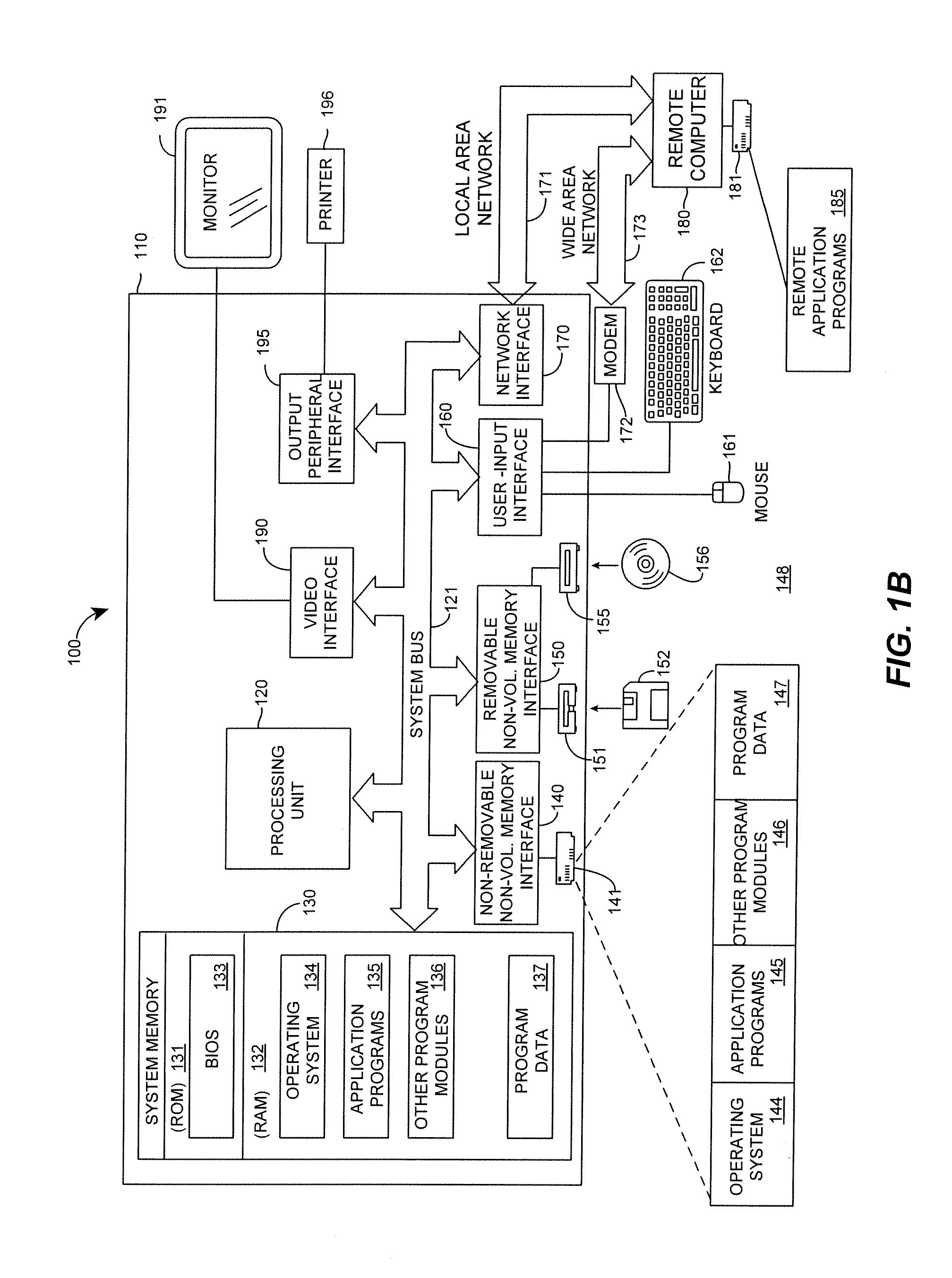

Share of Wallet (“SOW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumer's spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. The likelihood of default determined by the SOW model, when applied to a loan portfolio, can reduce the amount of credit enhancement required for an asset-backed securities rating.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

Method and apparatus for rating asset-backed securities

Share of Wallet (“SOW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumer's spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. The likelihood of default determined by the SOW model, when applied to a loan portfolio, can reduce the amount of credit enhancement required for an asset-backed securities rating.

Owner:EXPERIAN MARKETING SOLUTIONS

Credit enhancement systems and methods

InactiveUS20070233591A1Increasing equityMortgage payment is reducedFinancePayment architectureComputer scienceCredit enhancement

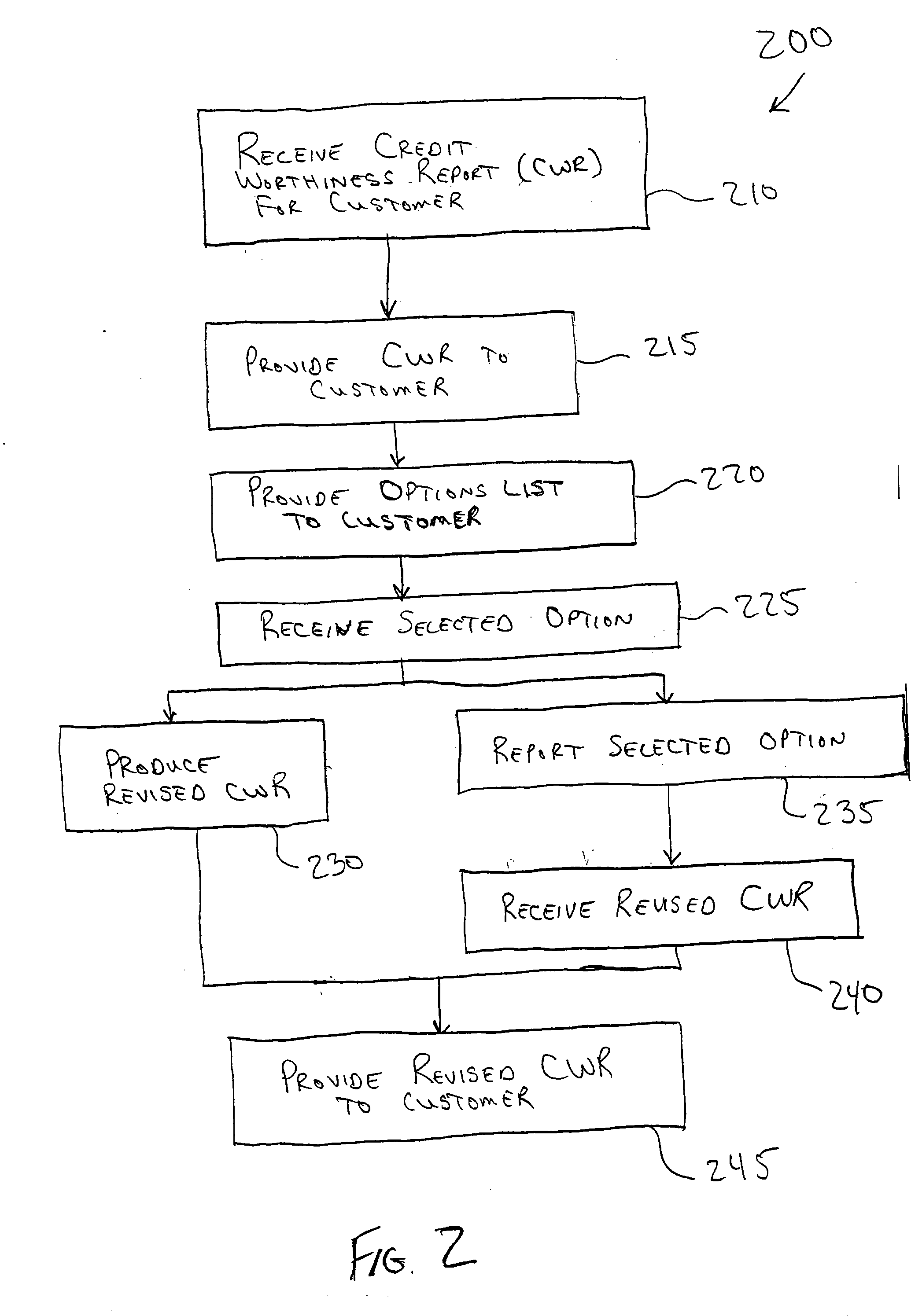

The present invention provides methods and systems for presenting financial and credit information to a customer. In one embodiment, the method includes receiving a credit worthiness report (CWR) for the customer, and providing the CWR to the customer. The method includes providing a list of selectable options to the customer, the options directed to at least one financial activity. A selected option is received from the customer, and a revised CWR is provided to the customer in response to the selected option. In this manner, the customer can examine how particular options or activities effect their credit worthiness.

Owner:FIRST DATA

Certificate of deposit portfolio system and method

InactiveUS20050114246A1Low costRaise interest ratesFinanceSpecial data processing applicationsIssuing bankEngineering

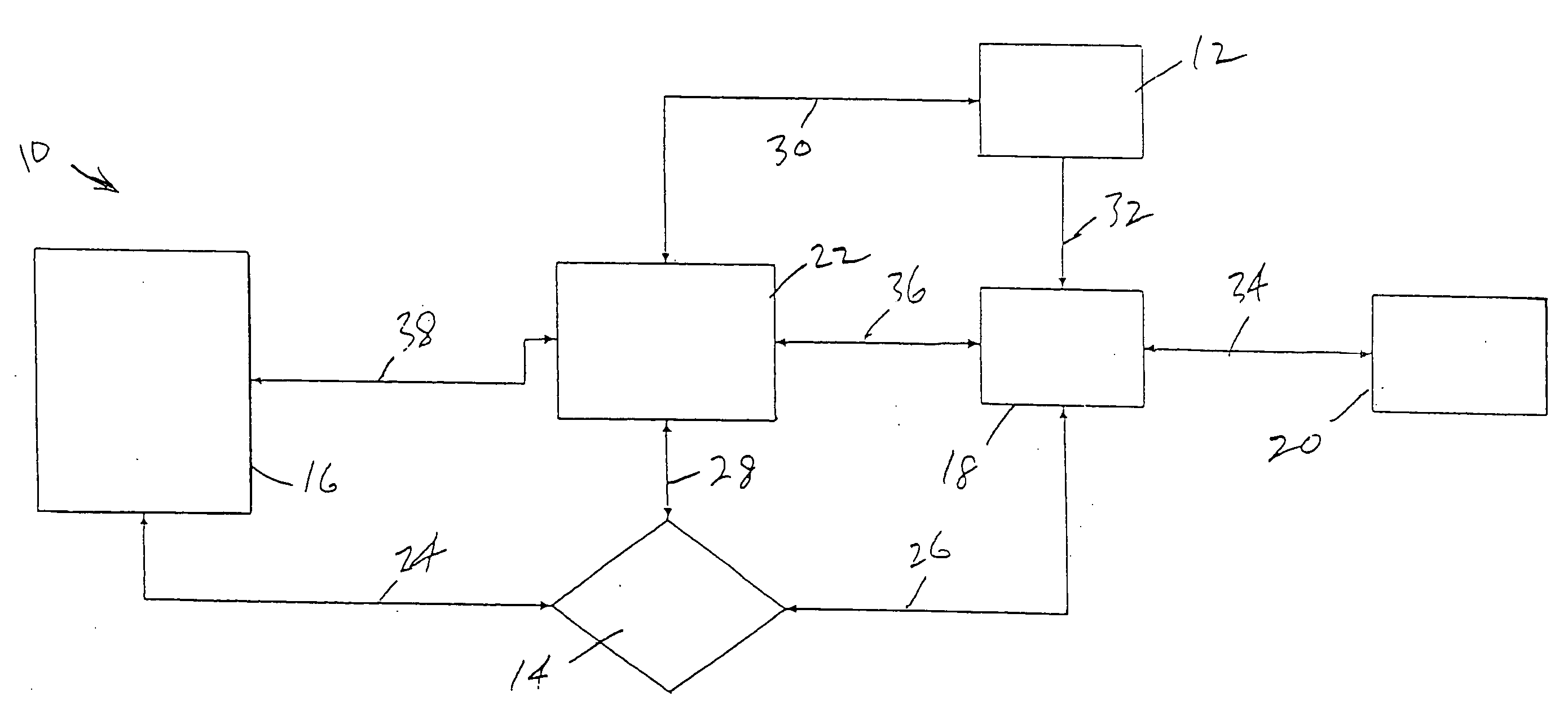

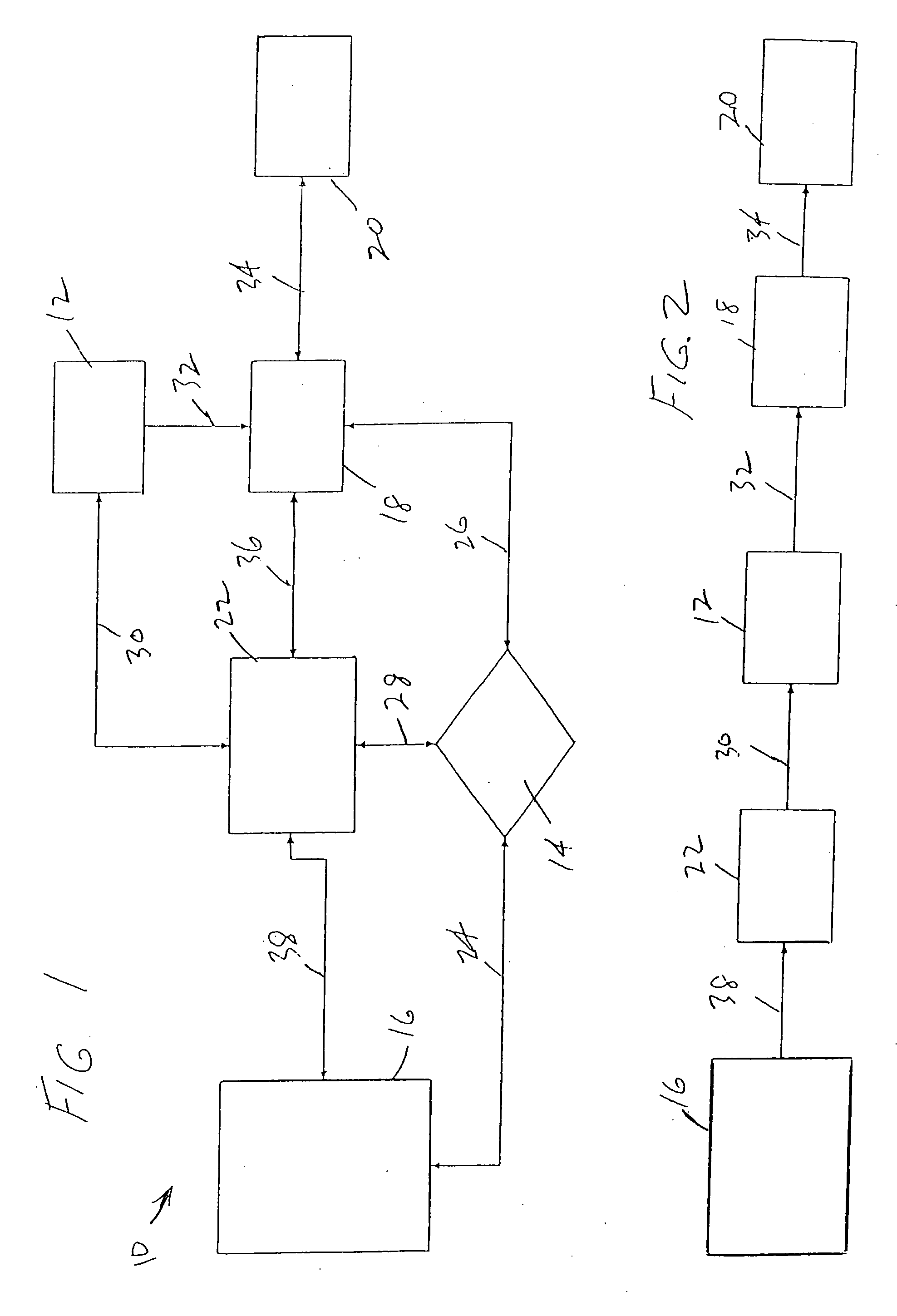

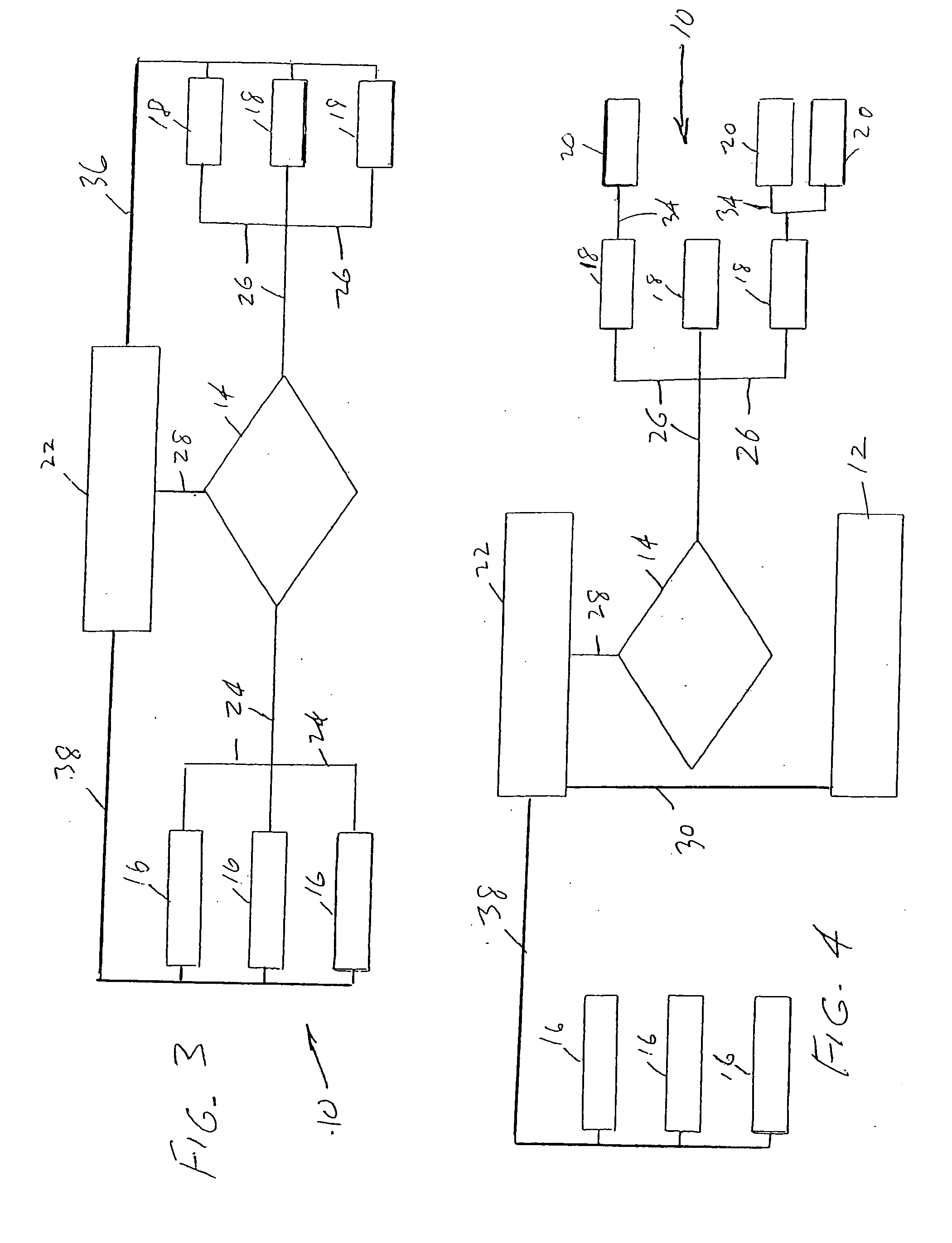

A certificate of deposit (“CD”) portfolio system and method to attract institutional investors through dealers to CD issuing small to medium sized community deposit taking institutions. The central entities of the system include a system operator and a system clearing house. The system operator contacts and signs up the institutions to become a part of the system. These institutions are community banks that are too small to individually attract institutional investors. It also contacts and signs up dealers and then unitizes FDIC insured CD's into single investment instrument portfolios which the dealers then market to their institutional investor clientele. The clearing house is in communication with the system operator, the institutions and the dealers to act as an agent facilitating transactions by issuing the CD's, handling funds, settling transactions, and acting as custodian / trustee for all transactions. The invention includes a system operator controlled internet website to provide access to information to for the use of CD issuing banks, the system clearing house, the system operator and the dealers. In effect the invention creates a meeting place for small banks to pool their FDIC insured CD's together into single investment instrument portfolios large enough to attract institutional investors at favorable interest rates because of the credit enhancement resulting from full FDIC insurance of the portfolio. This is achieved because the system and method prevent exceeding the $100,000.00 FDIC insurance limit per investor per bank.

Owner:INSTIONAL DEPOSITS

Programmable financial instruments

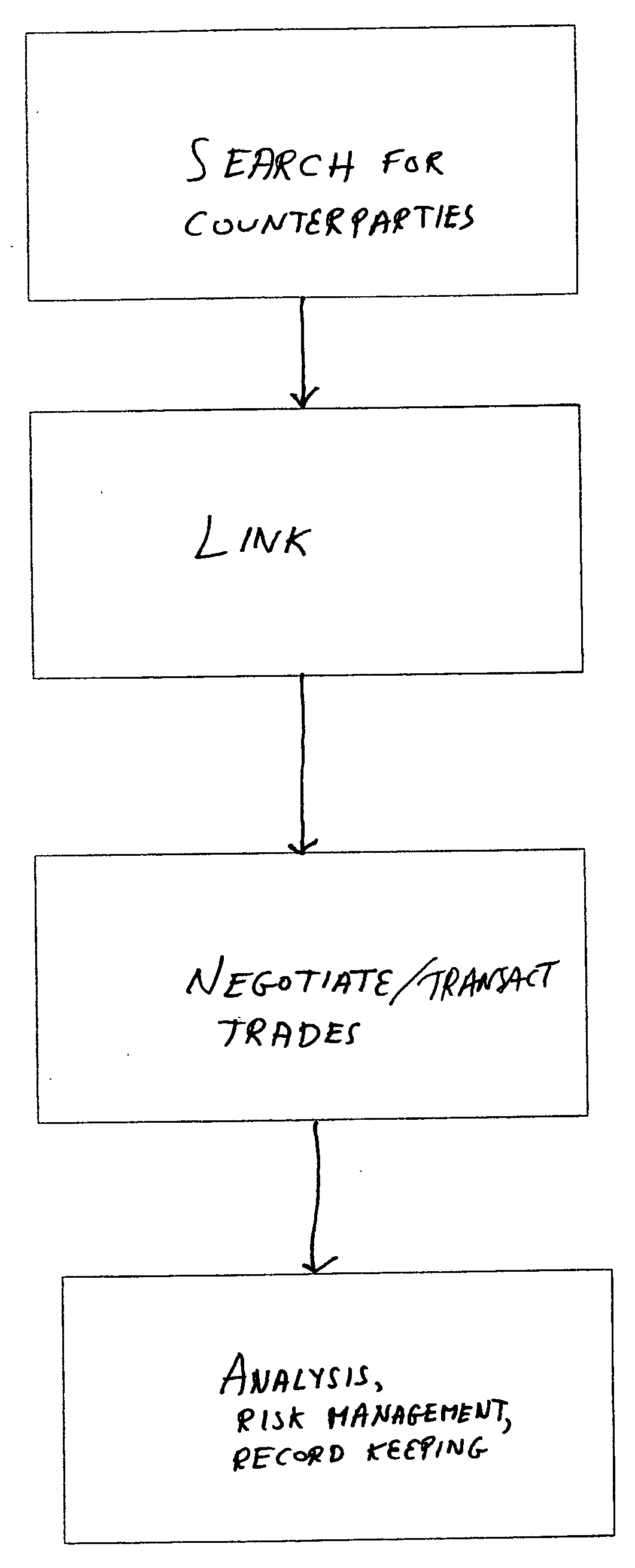

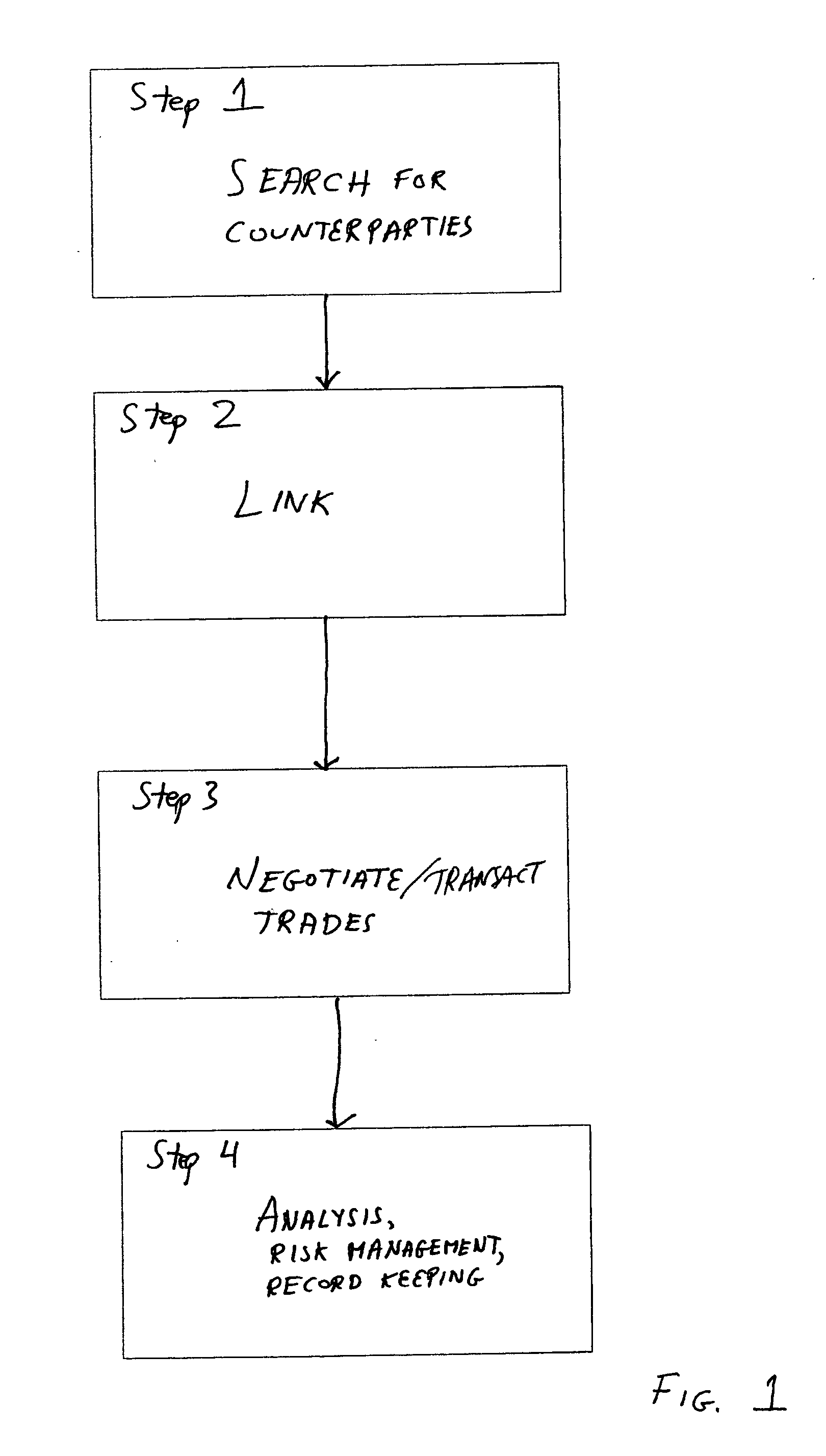

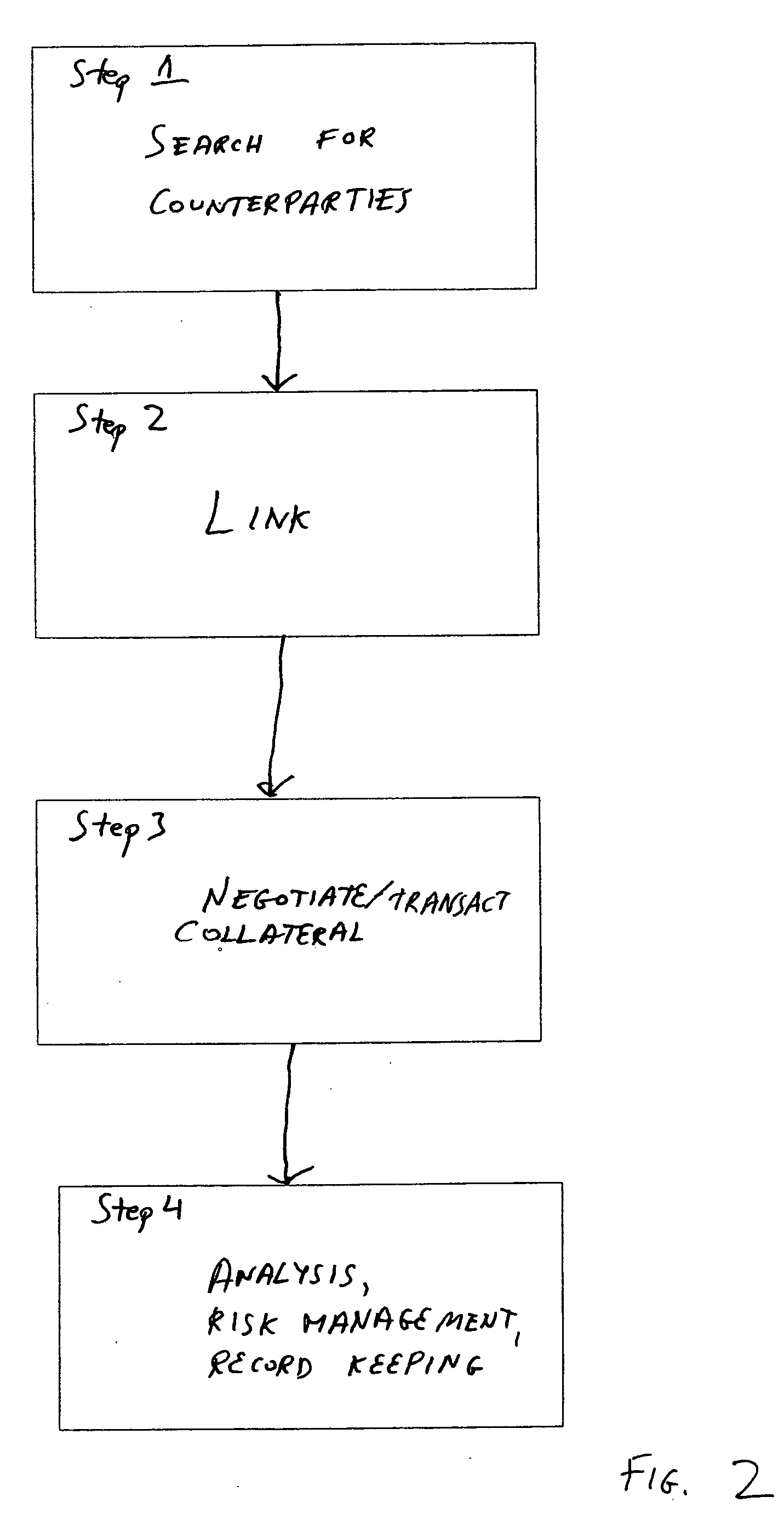

A method and system is disclosed for creating and using programmable financial instruments. The method and system addresses the problems caused by limiting the scope of financial instruments to inert objects, whether considered as abstract data or in a physical embodiment such as a paper certificate. Applications of the method and system include trading, portfolio management, collateralization, securitization, securities lending, securities borrowing, and credit enhancement.

Owner:GROZ MARC MICHAEL

Method and apparatus for rating asset-backed securities

ActiveUS7610243B2Efficient use ofEfficient managementFinanceInput/output processes for data processingBalance transferData source

Share of Wallet (“SOW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumer's spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. The likelihood of default determined by the SOW model, when applied to a loan portfolio, can reduce the amount of credit enhancement required for an asset-backed securities rating.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

Reference pools as credit enhancements

Owner:FREDDIE MAC

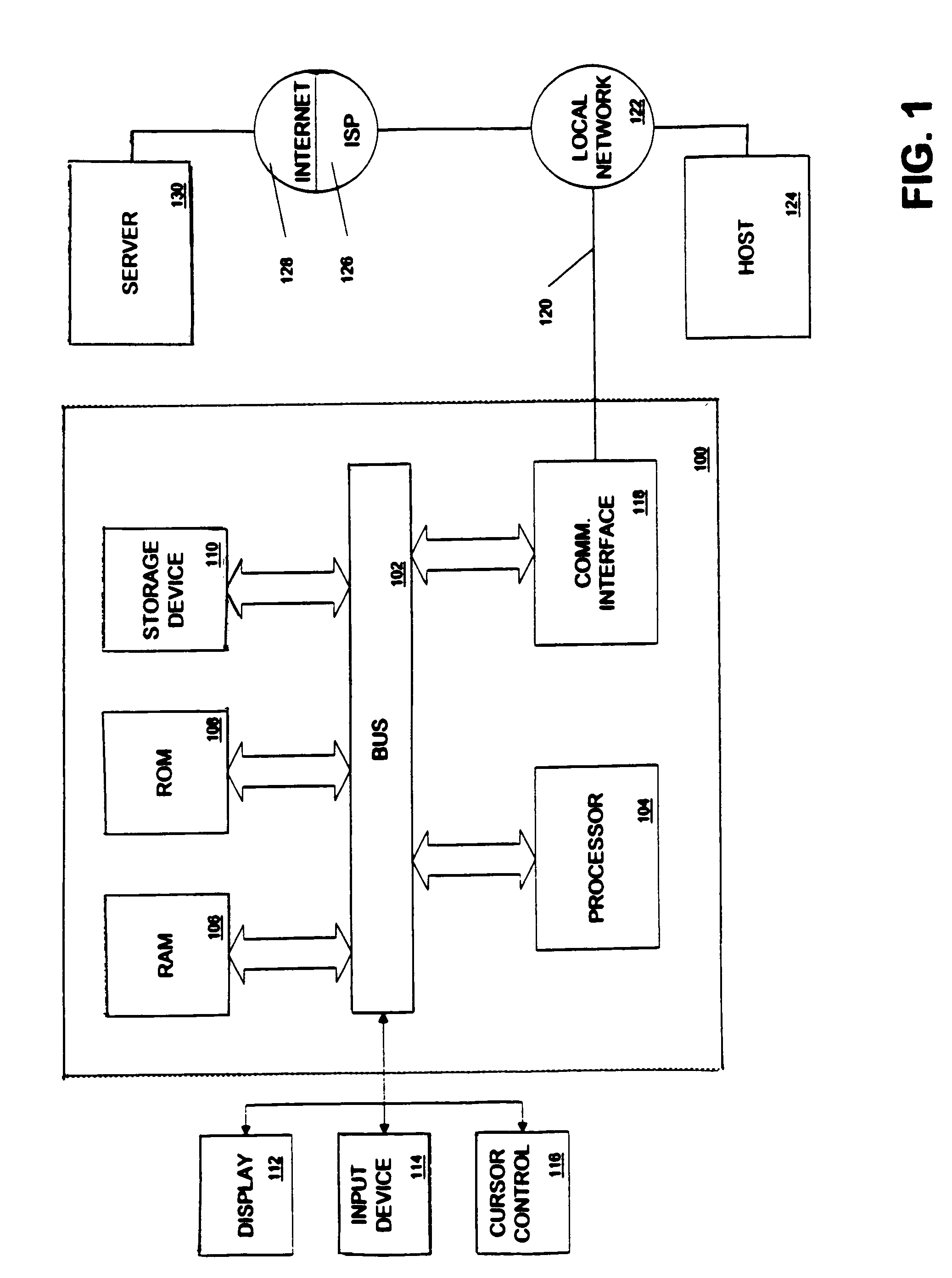

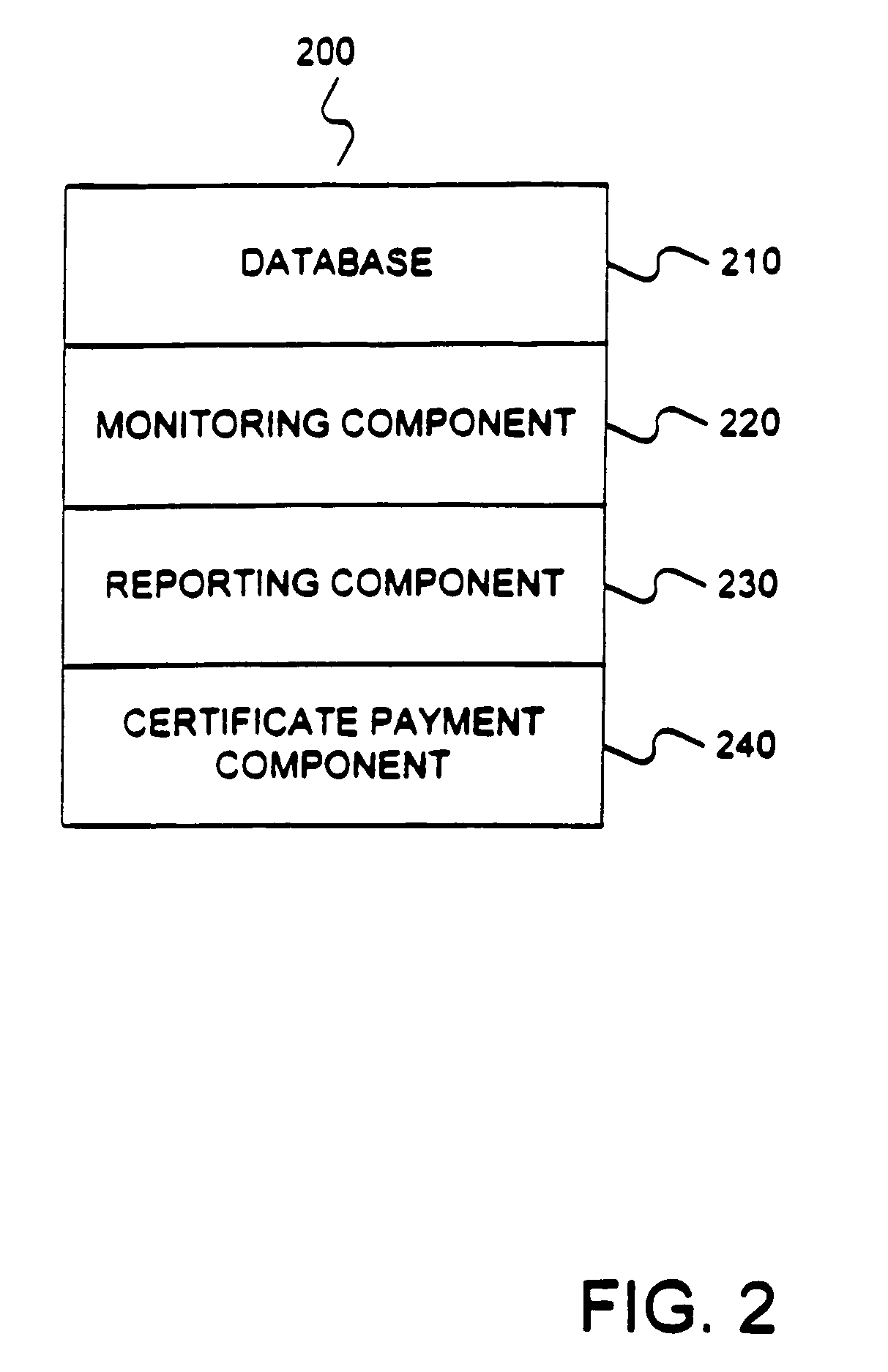

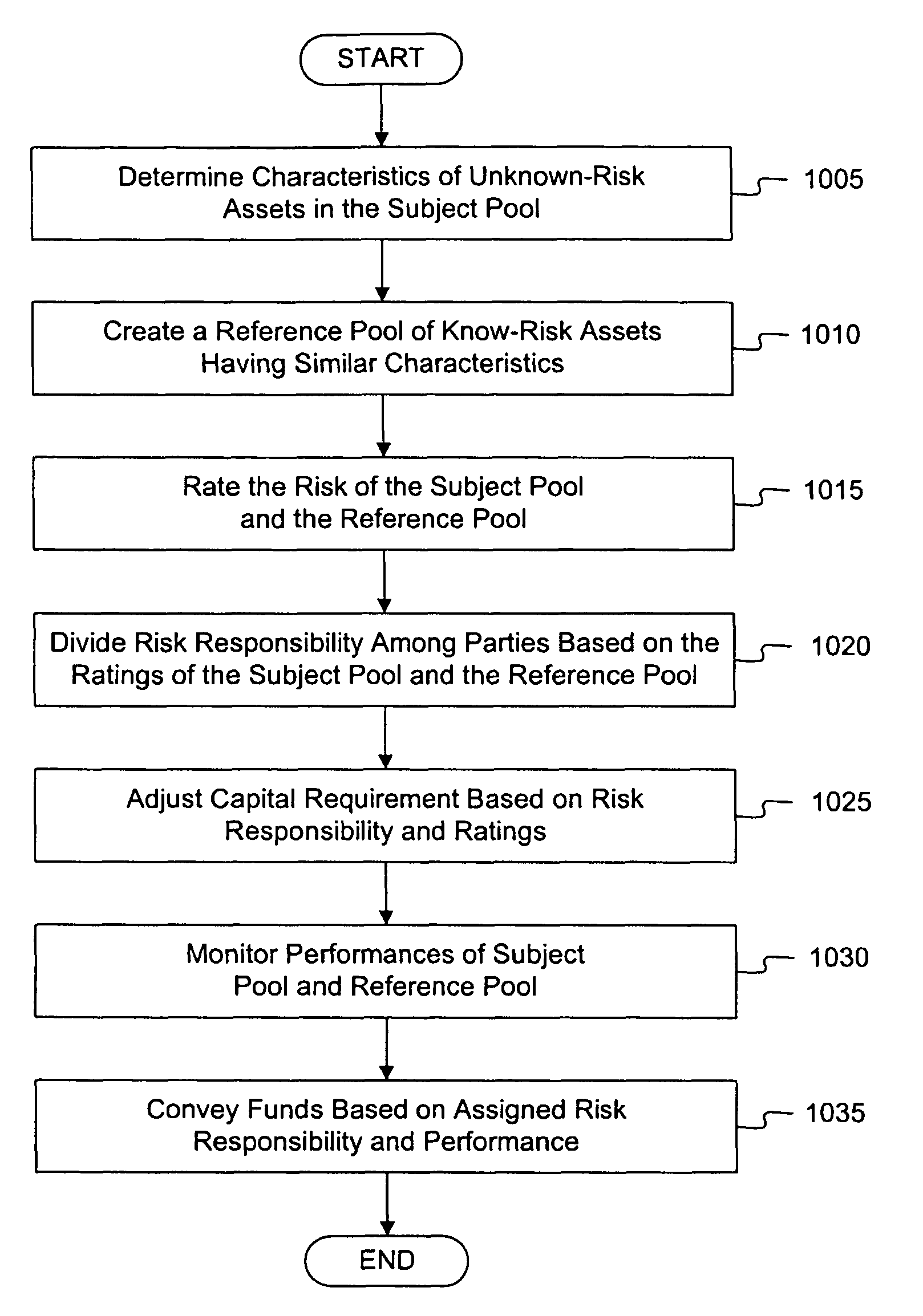

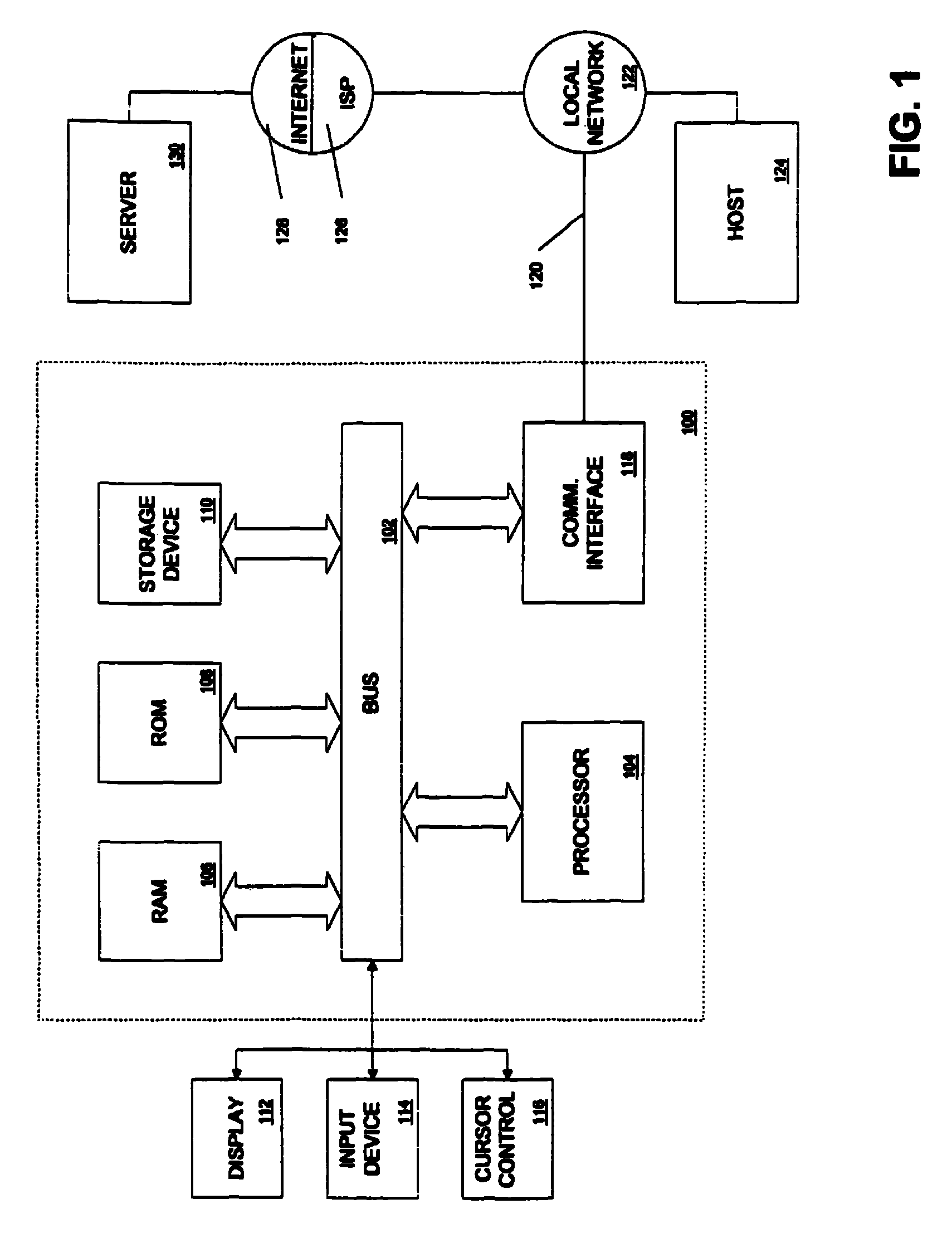

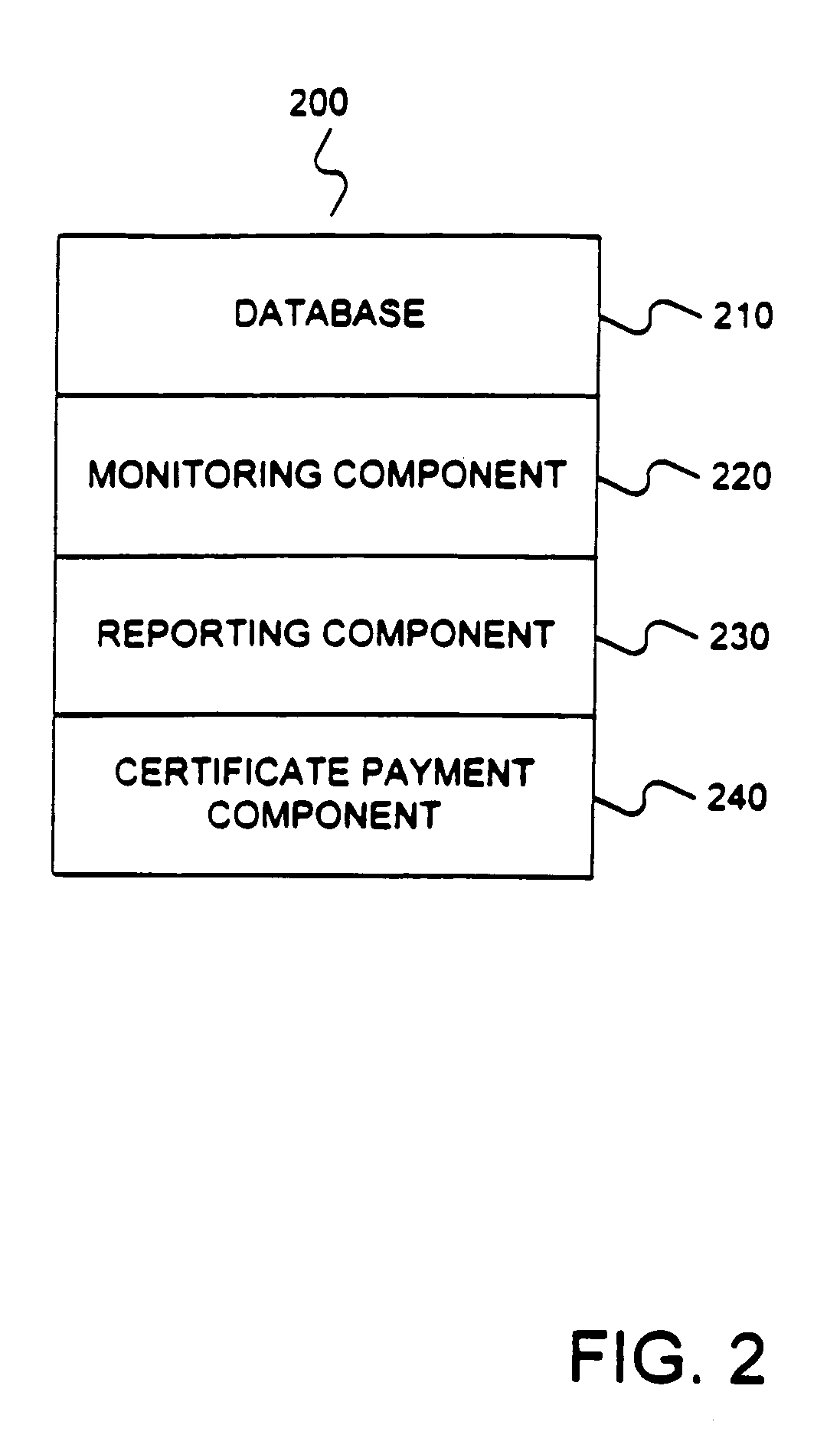

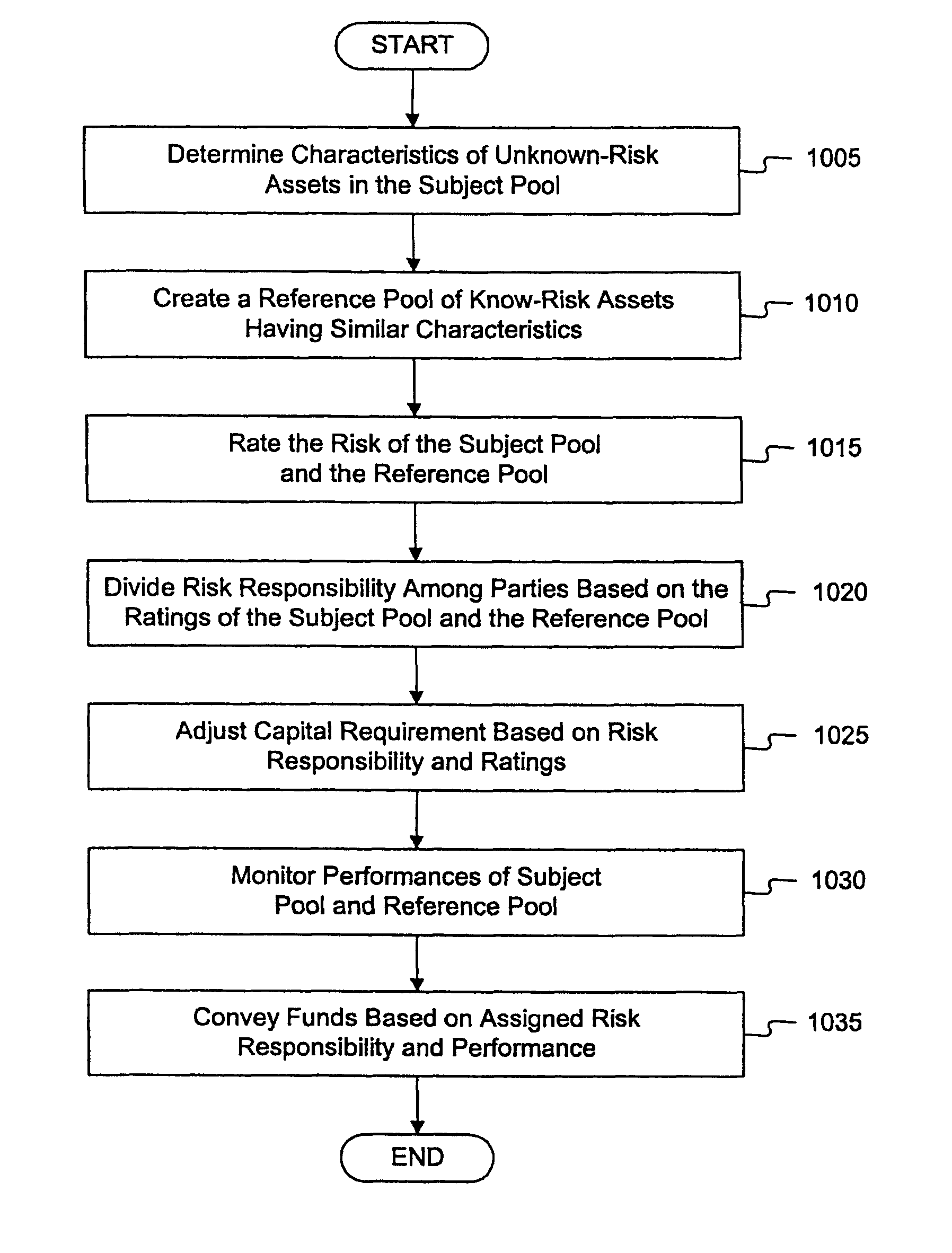

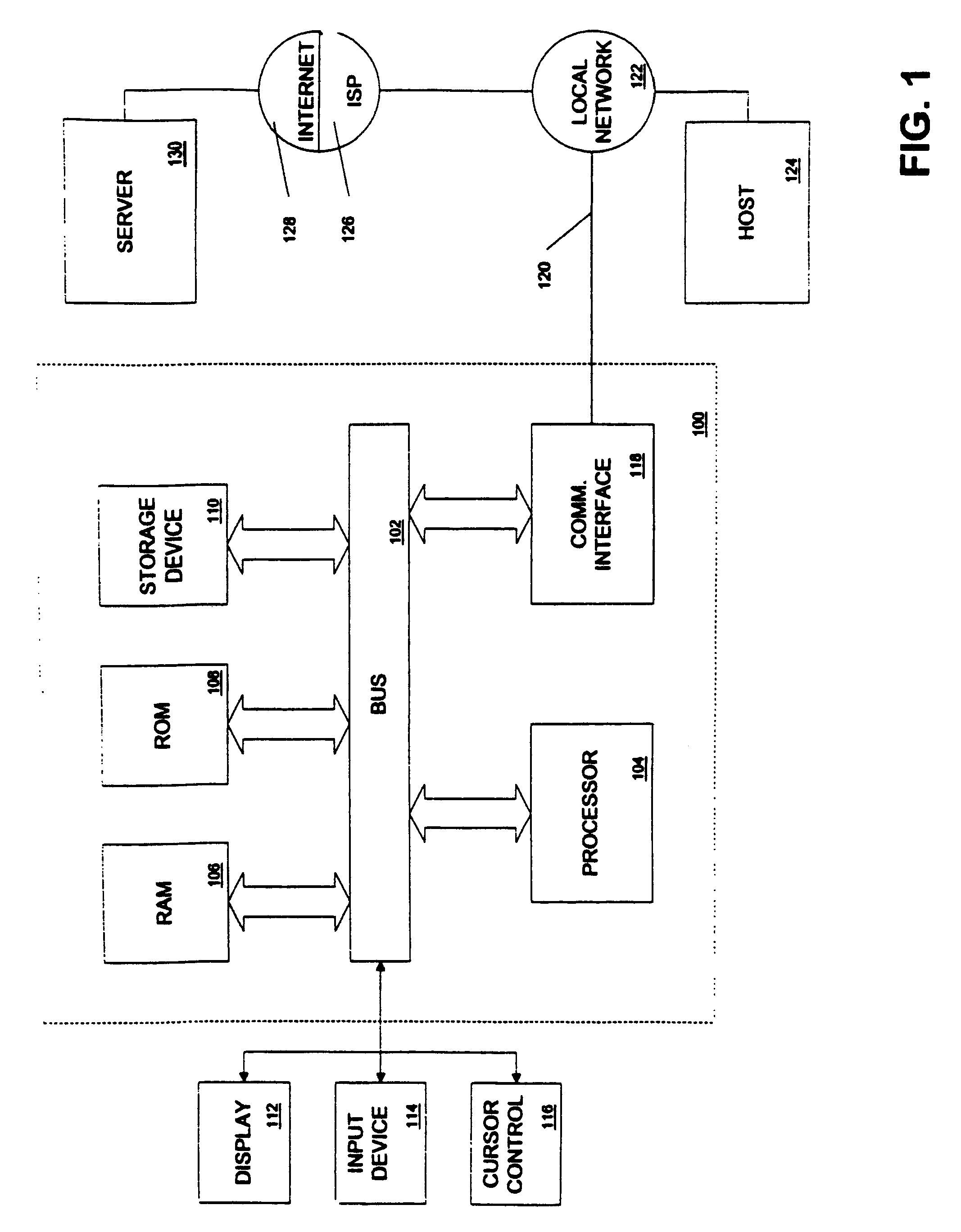

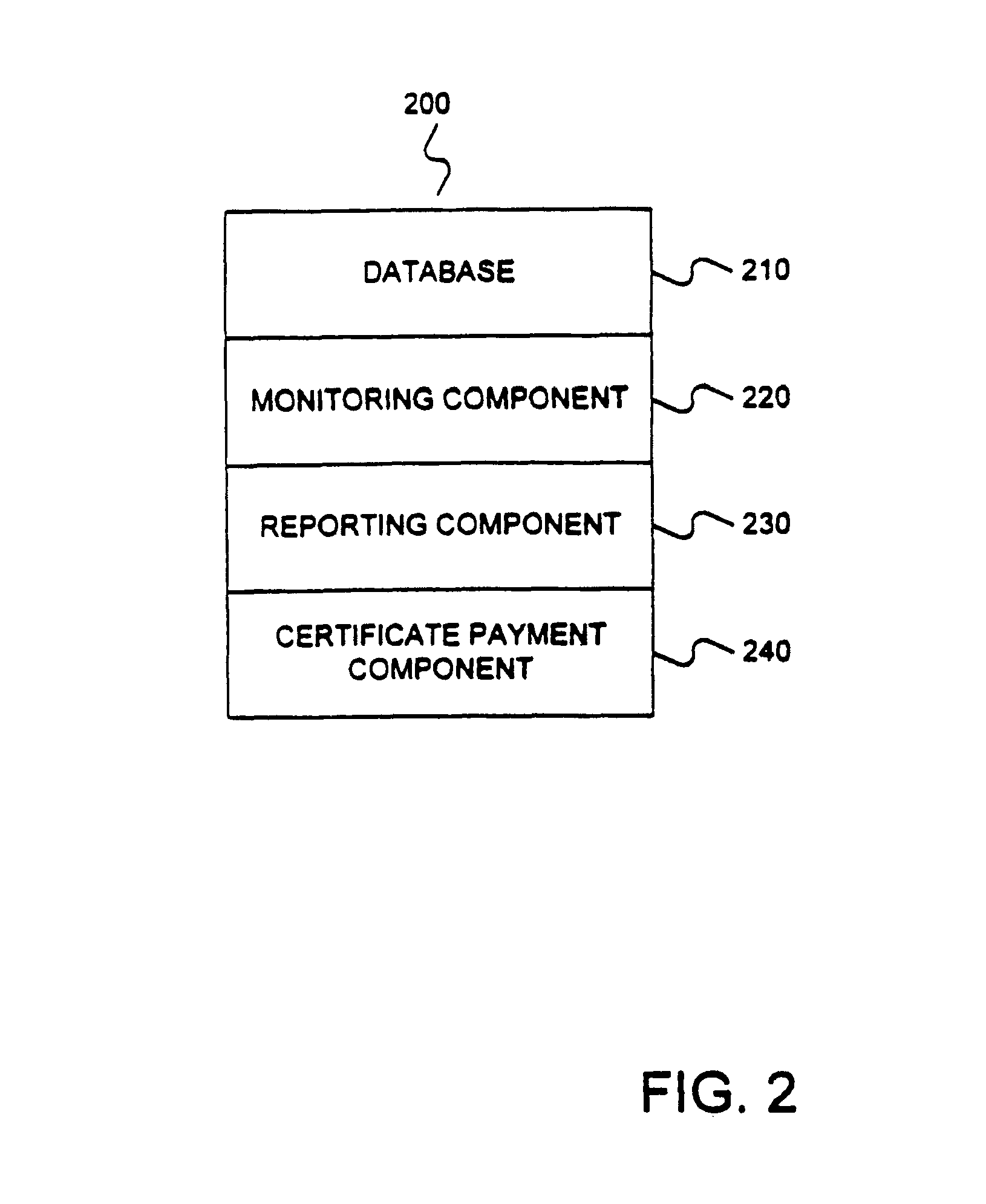

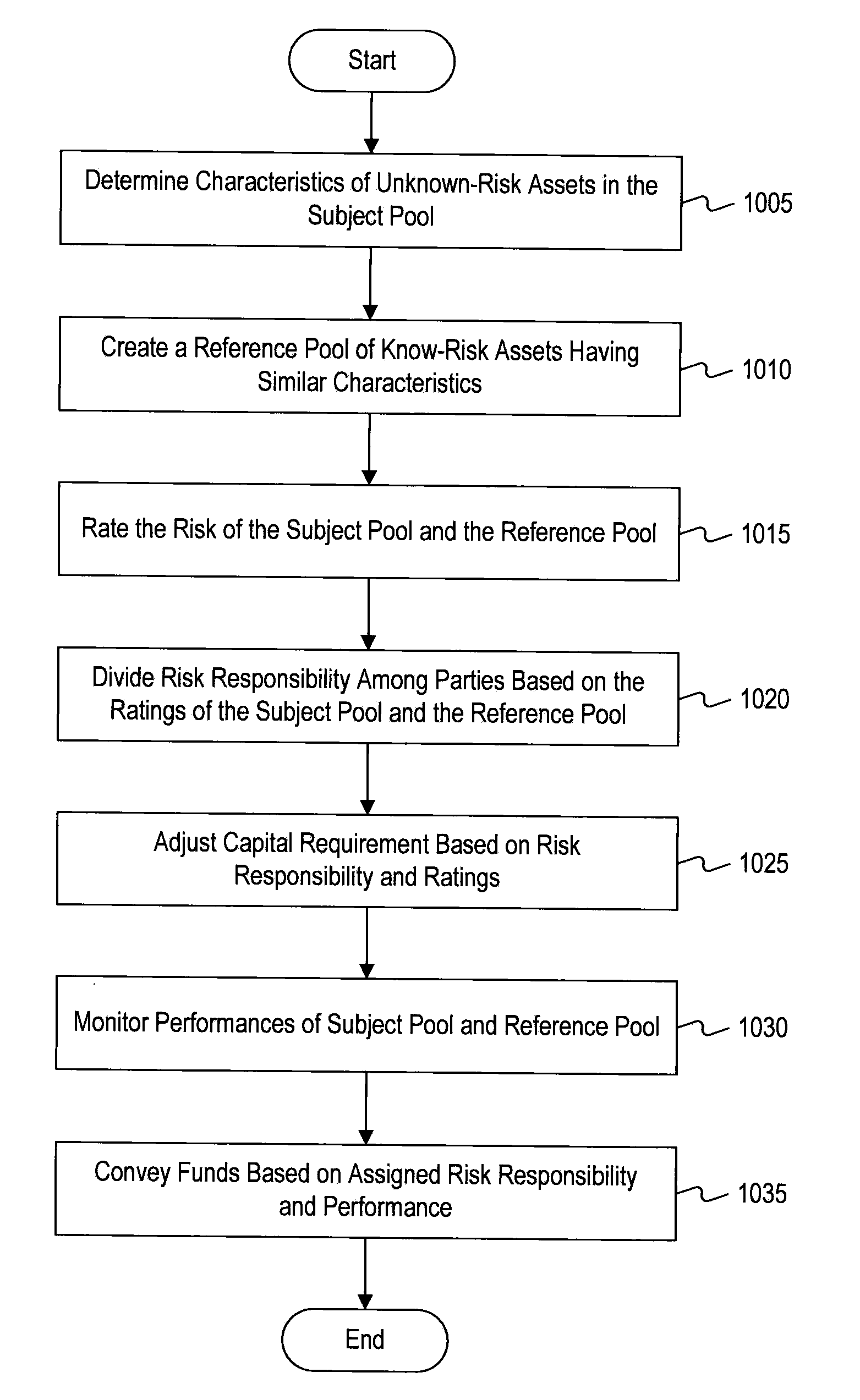

Risk-based reference pool capital reducing systems and methods

Embodiments consistent with the present invention provide a credit enhancement structure for risk allocation between parties that minimizes the regulatory capital reserve requirement impact to an institution subject to capital reserve requirement. A subject pool of assets held by the institution, such as a pool of loans, is rated to determine its risk levels. Based on the rated risk levels, a guarantor party agrees to be responsible for a portion of the risk associated with the pool of assets, which may define the maximum risk exposure of the institution holding the asset pool. The risk-rated capital reserve requirements are applied to the asset pool based on the risk level rating and the guarantor's agreed upon risk responsibility such that the institution holds a reduced amount of reserve capital compared to what it would otherwise be required to hold.

Owner:HEUER JOAN D +6

Method and apparatus for rating asset-backed securities

Share of Wallet (“SoW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumer's spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. The likelihood of default determined by the SoW model, when applied to a loan portfolio, can reduce the amount of credit enhancement required for an asset-backed securities rating.

Owner:MEGDAL MYLES G +2

Computer-system for Shariah-compliant computer-aided method for securing a Shariah-compliant credit enhancement

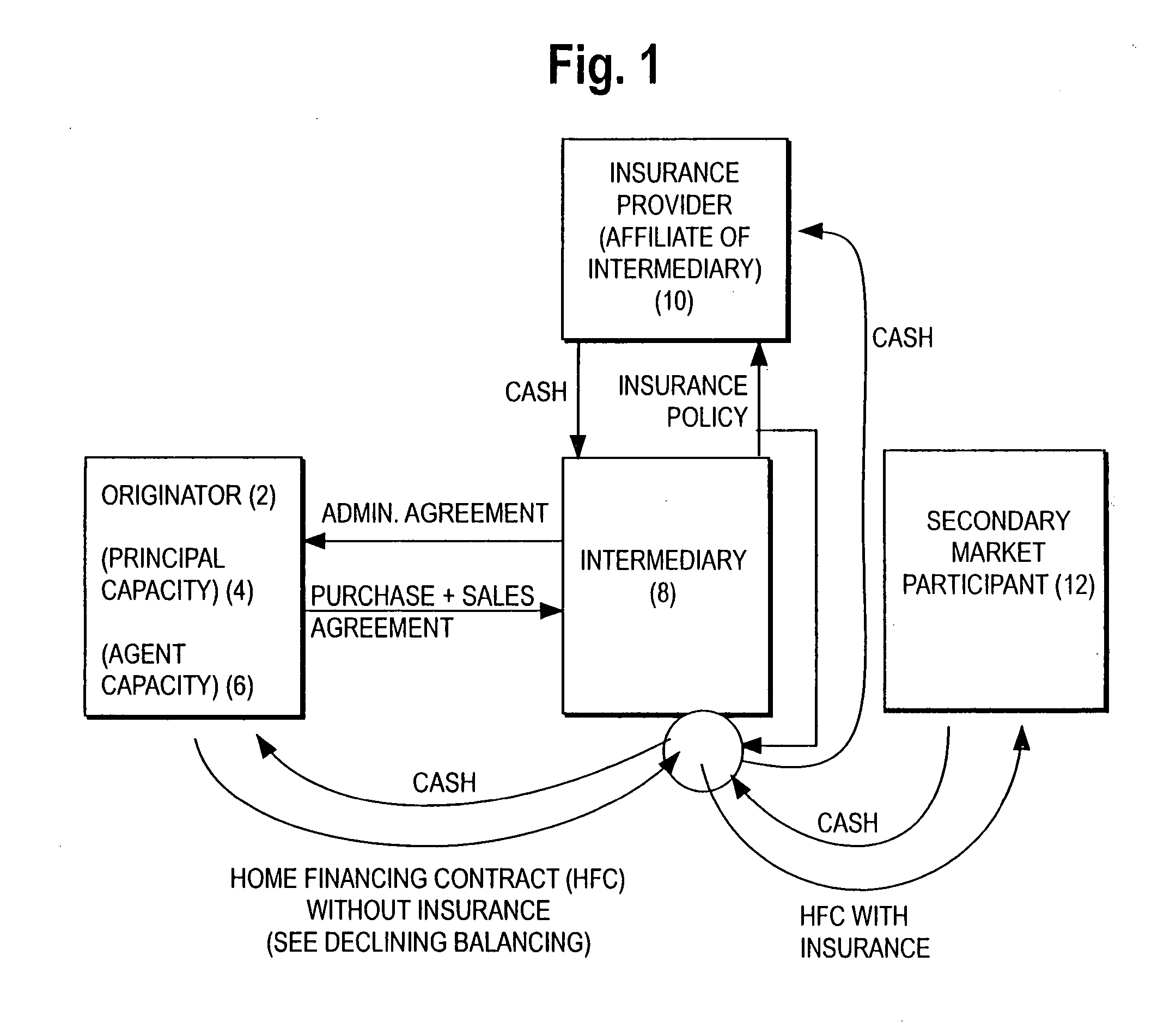

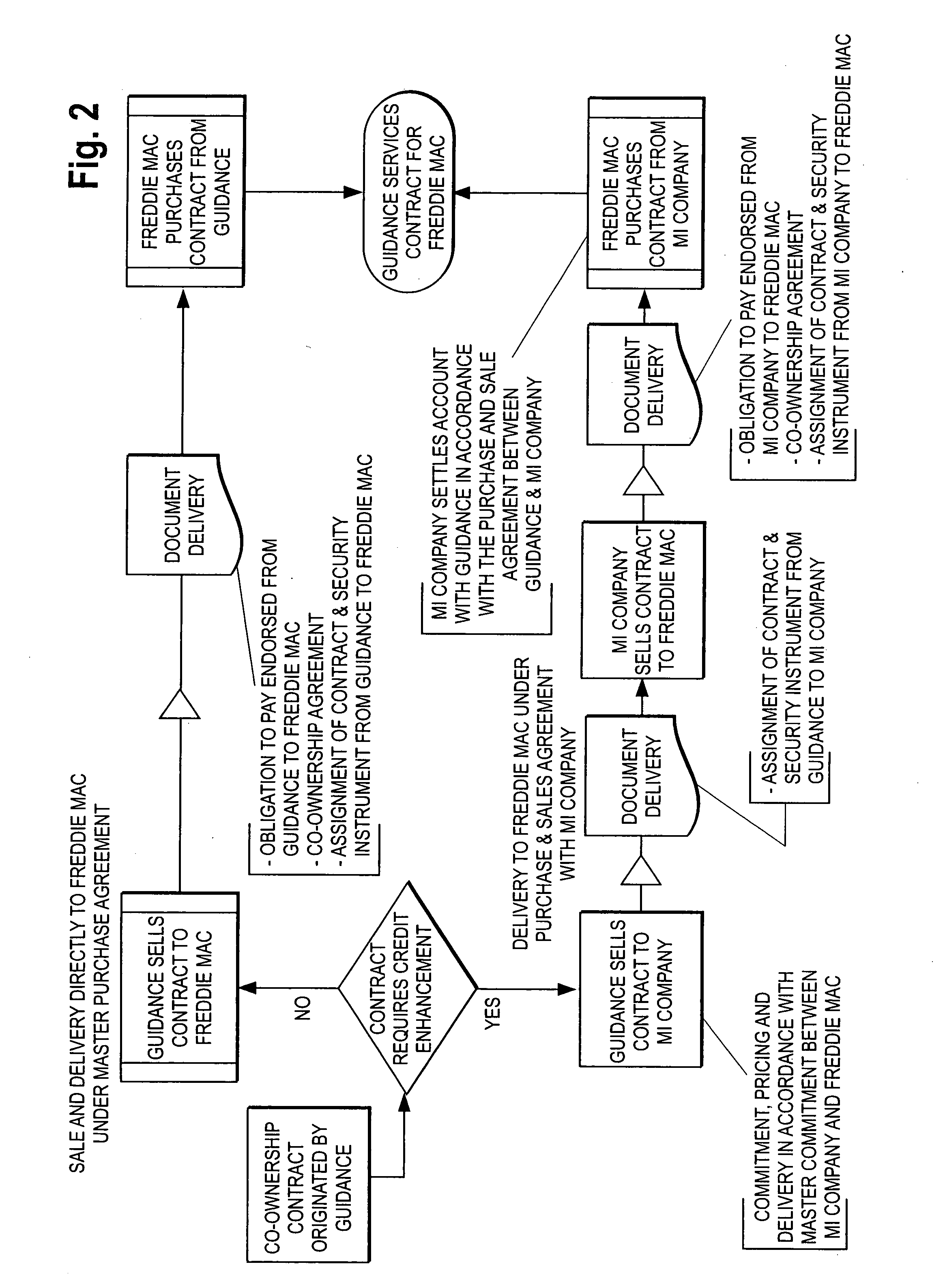

InactiveUS20040177029A1FinanceSpecial data processing applicationsDocumentation procedureComputerized system

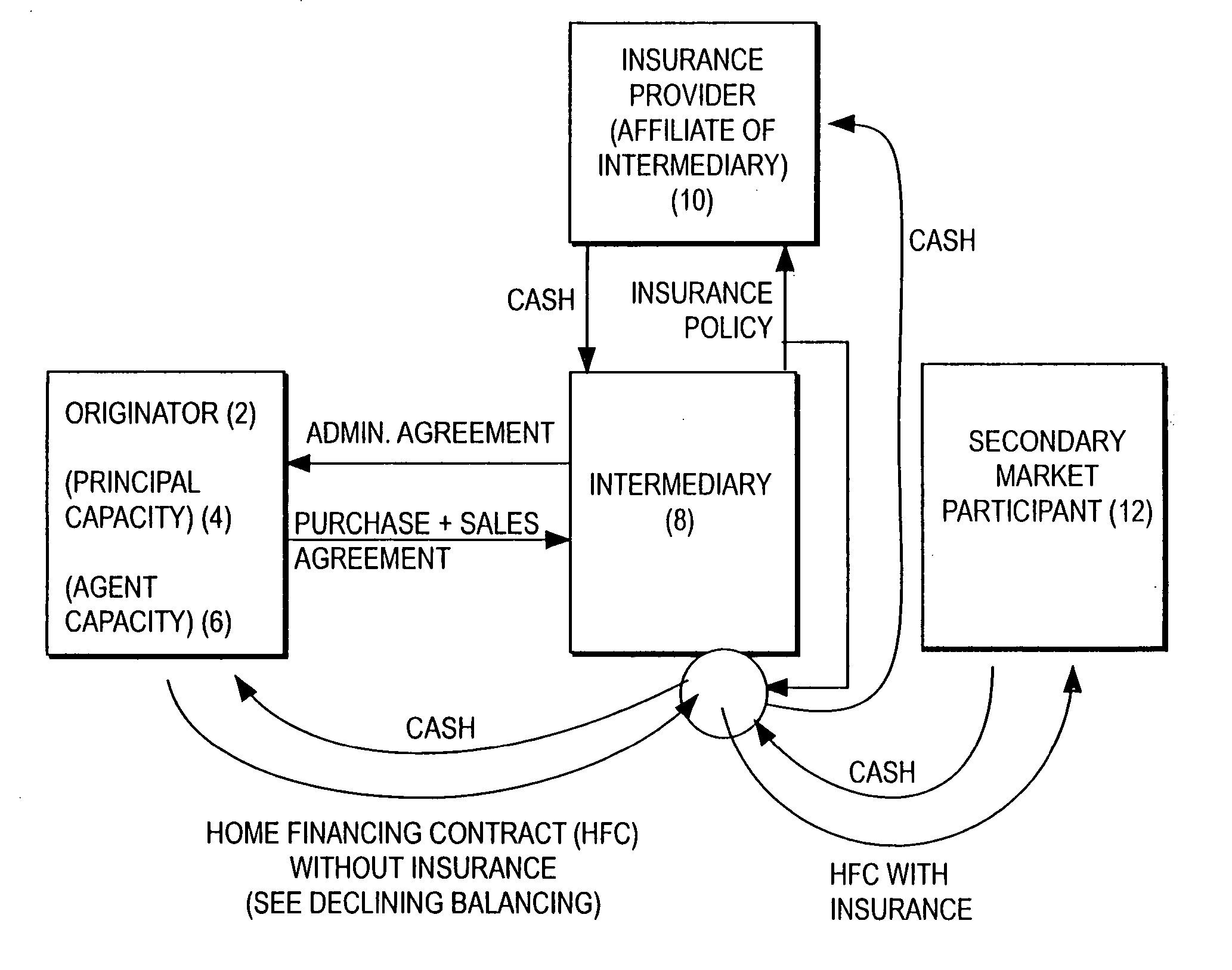

A computer system and computer-aided method for securing a Shariah-compliant credit enhancement, the method including the steps of: entering a property value and a property financing amount as input to a computer; computing, from the property value and a property financing amount, a quantity of mortgage insurance coverage required to satisfy a Shariah-compliant credit enhancement; and securing a mortgage insurer's commitment to an intermediary to insure a home financing contract, wherein the intermediary is not a lender or borrower. System-provided documentation is also included.

Owner:GUIDANCE FINANCIAL GRP

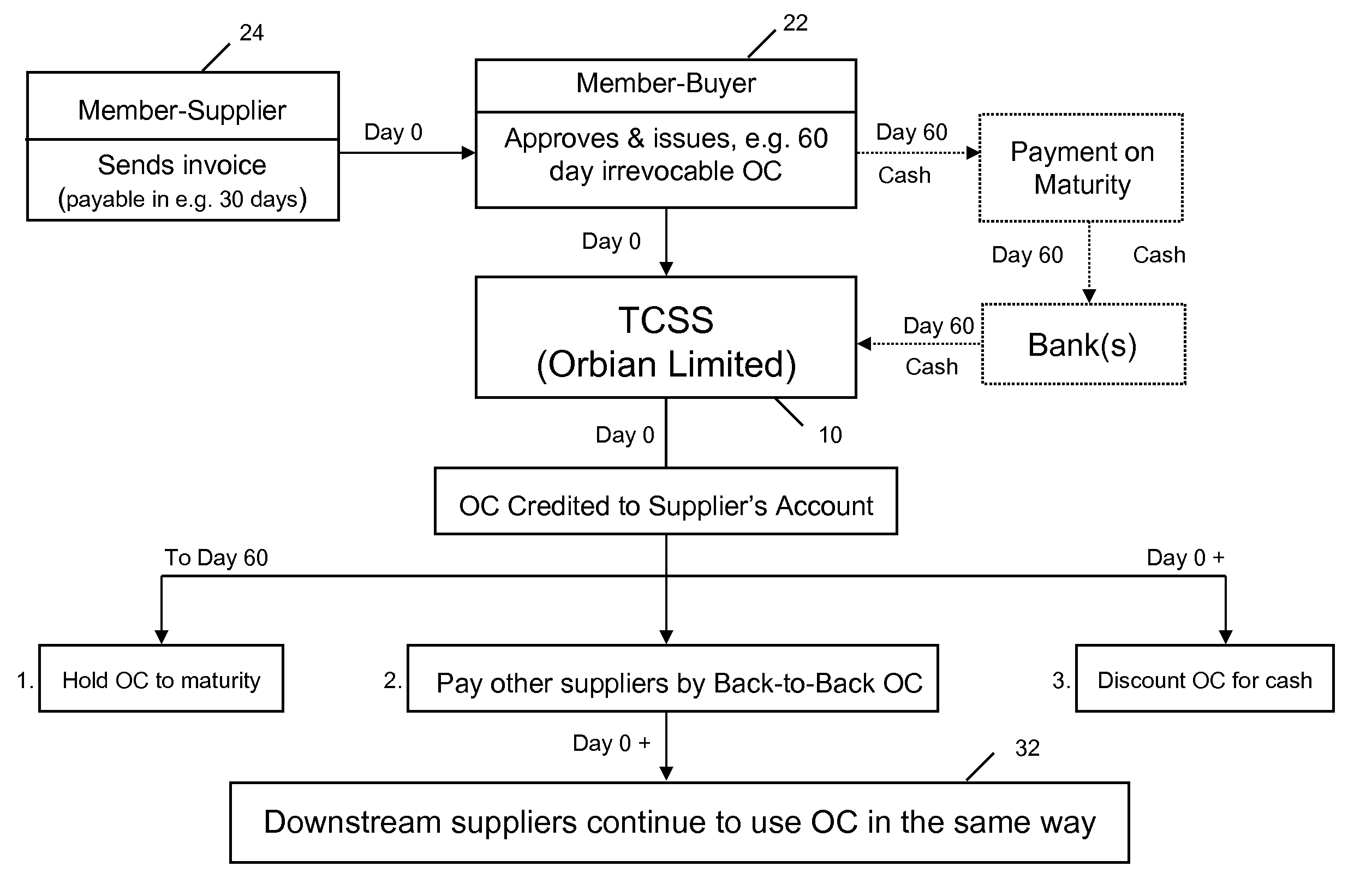

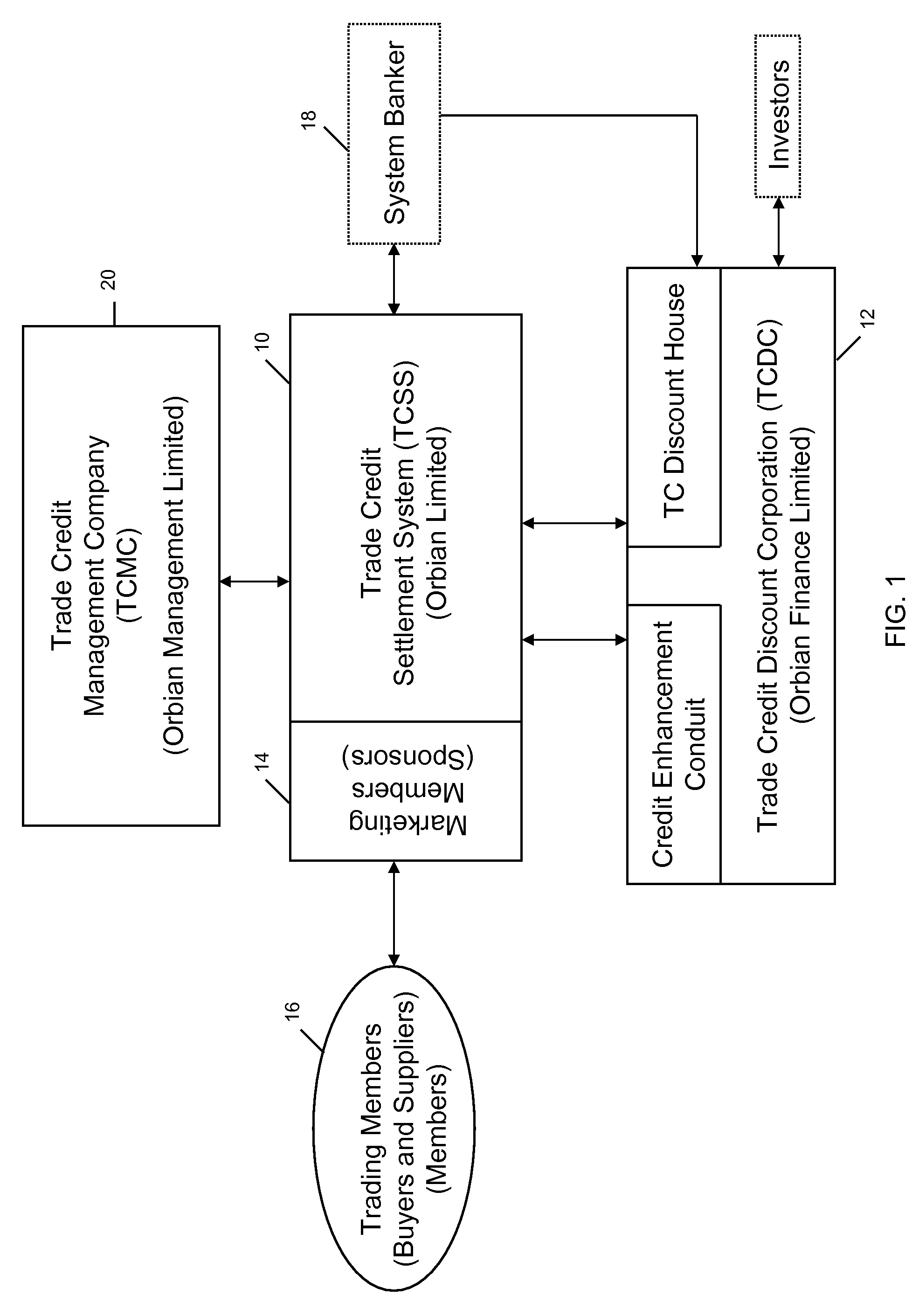

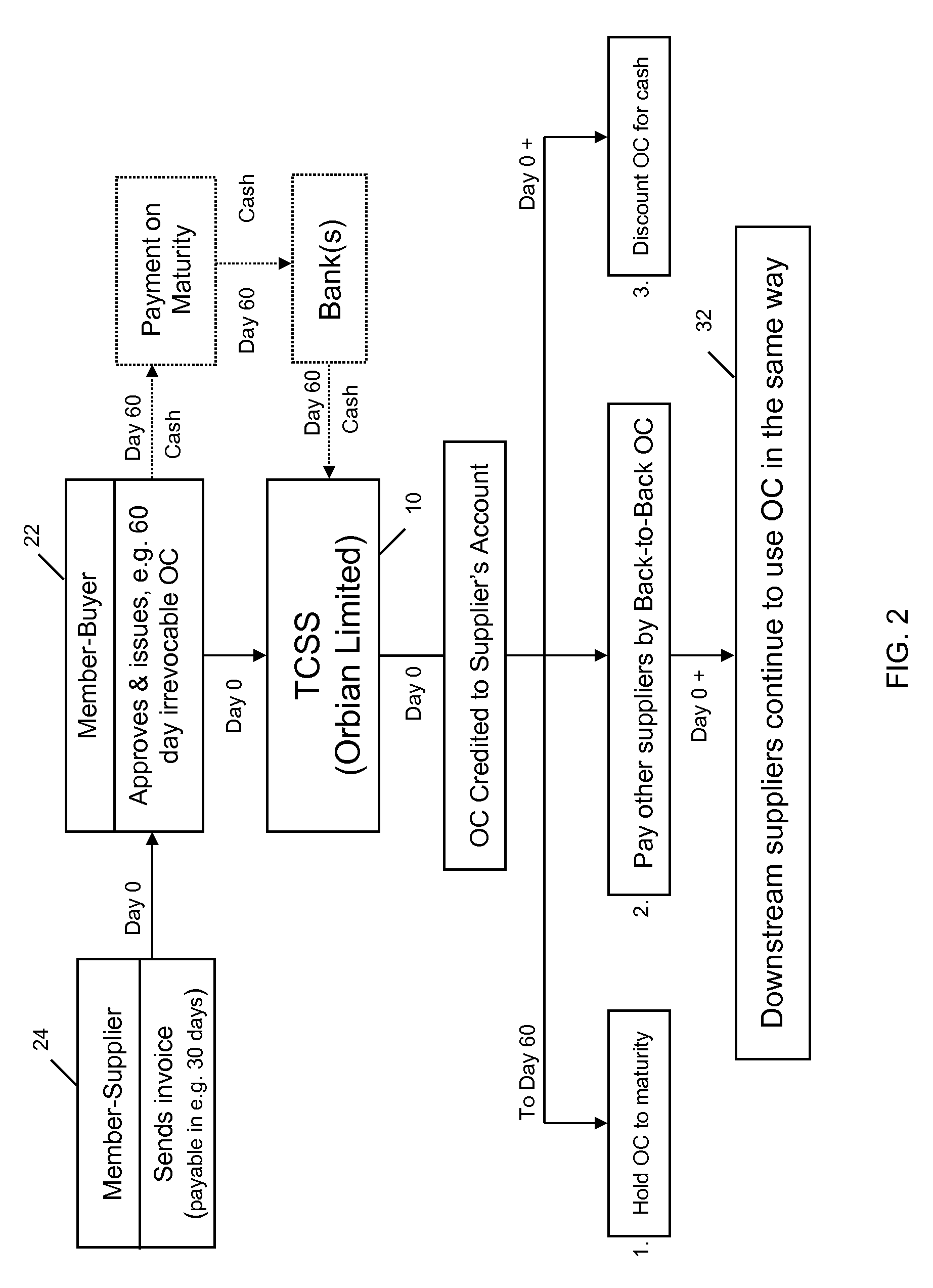

System and Method of Transaction Settlement Using Trade Credit

A method and system for settling a transaction with trade credit value which makes use of computer hardware and software, allows Members of a trade credit settlement system to transfer electronic instruments, called trade credits, in exchange for goods and services. These trade credits are effectively electronic bills of exchange that are divisible, transferable, discountable, continuously available and have been credit-enhanced to A / P1 status. Sponsors facilitate the system by registering buyers and suppliers as Members in the system and offering them operational accounts and drawdown accounts with authorized lines of credit. A Member-buyer approves the purchase invoice of a Member-supplier and authorizes the Sponsor to transfer trade credit value from the Member-buyer's operational and / or drawdown account into the operational account of the Member-supplier. The trade credit value received by the Member-supplier can be held in the Member-supplier's operational account until it matures, or discount it to cash before it matures, or transfer it to other Members for the purchase of goods or services.

Owner:KAY ALAN +2

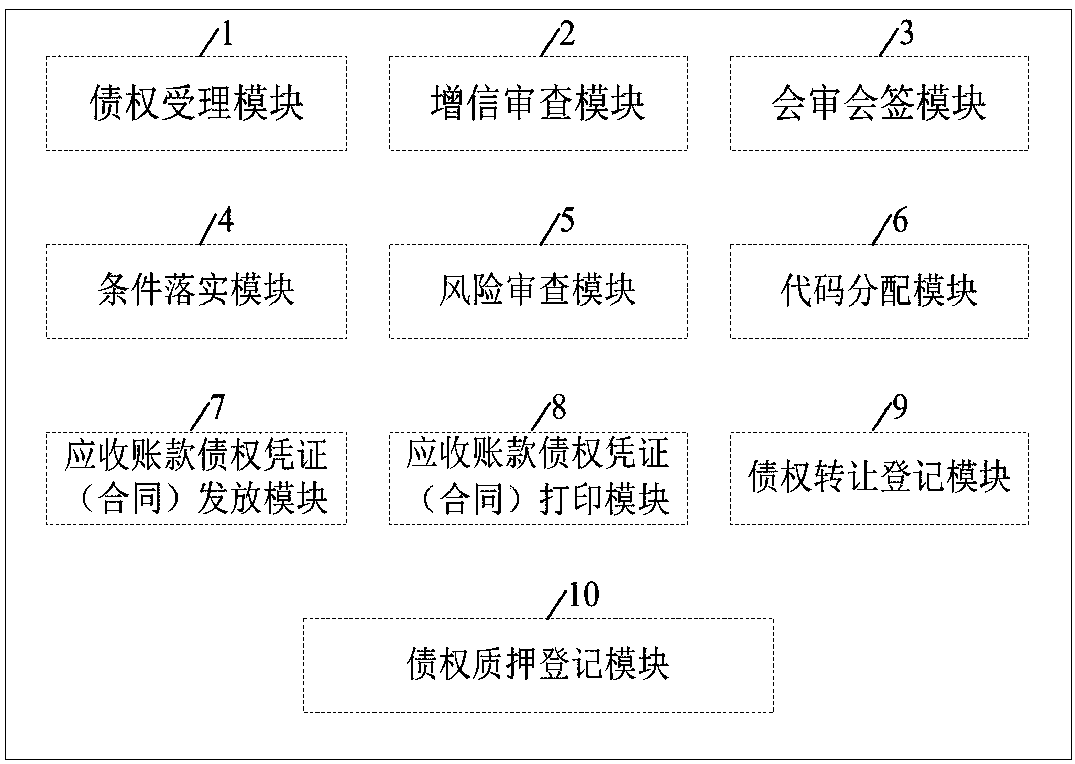

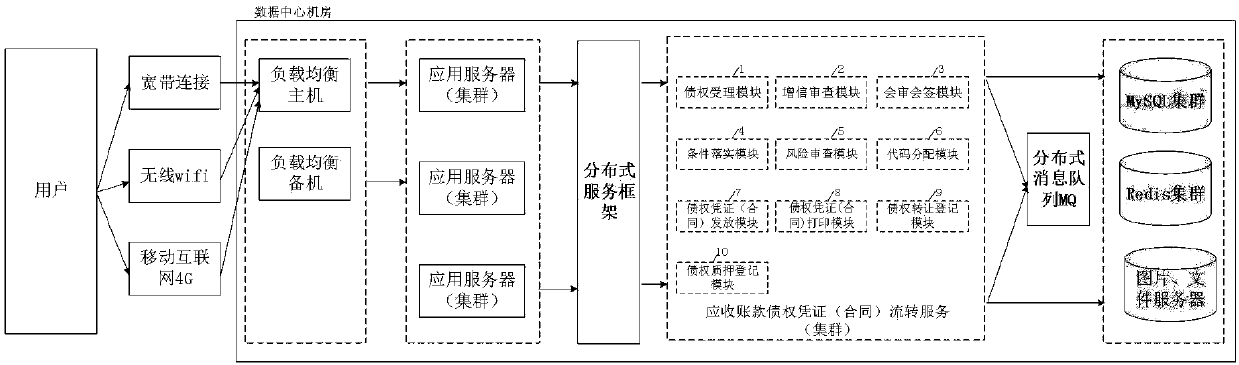

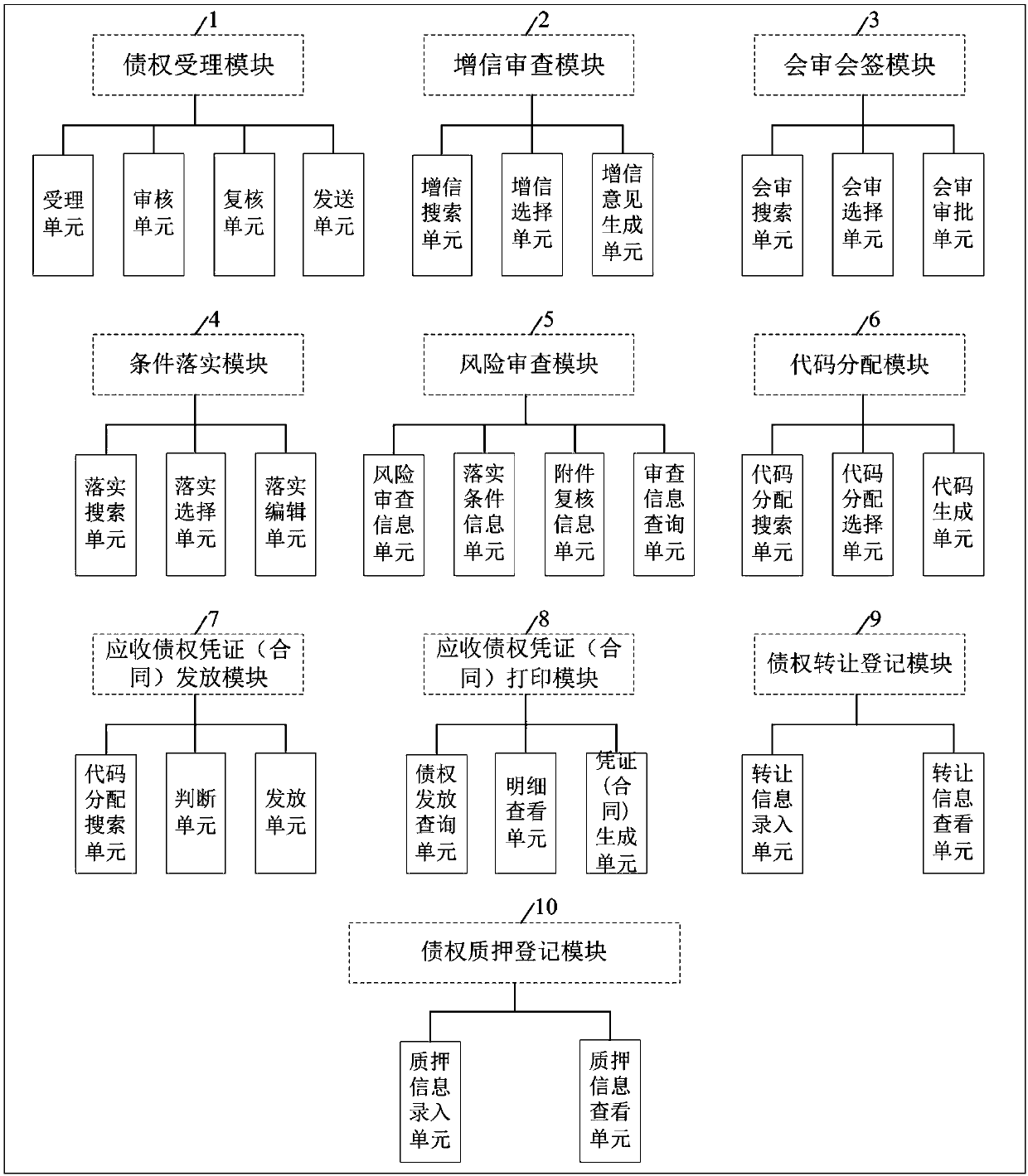

Account receivable creditor's rights certificate (contract) transfer system

ActiveCN108038781AEffectively resolve debtDiversified solutions to social conflicts and disputesFinanceCredit systemMedium enterprises

The invention discloses an account receivable creditor's right certificate (contract) transfer system and method. The system comprises a creditor's right acceptance module, a risk review module, a code distribution module, an account receivable creditor's right certificate (contract) issuing module, an account receivable creditor's right certificate (contract) printing module, a creditor's right assignment module and a pledge registration module. Through sciences and technologies and a credit enhancement manner, account receivables, in static state, among various economic subjects are converted into paper or electronic account receivable certificates (contracts) which integrates the functions of financing, commodity financing, transfer, transaction and refunding (countervailing); in practice, solely state-owned account receivable creditor's right management companies are established by local governments or group applications are organized via mediation such as people mediation, industrial mediation and commerce chamber mediation; and through the system, account receivable creditor's right certificate (contract)s are issued for account receivables which accords with conditions so asto carry out transfer, so that a positive role is played in solving difficult financing of small and medium enterprises, resolving chain debts, resolving the debts of local governments and pushing the construction of credit systems.

Owner:安徽海汇金融投资集团有限公司 +1

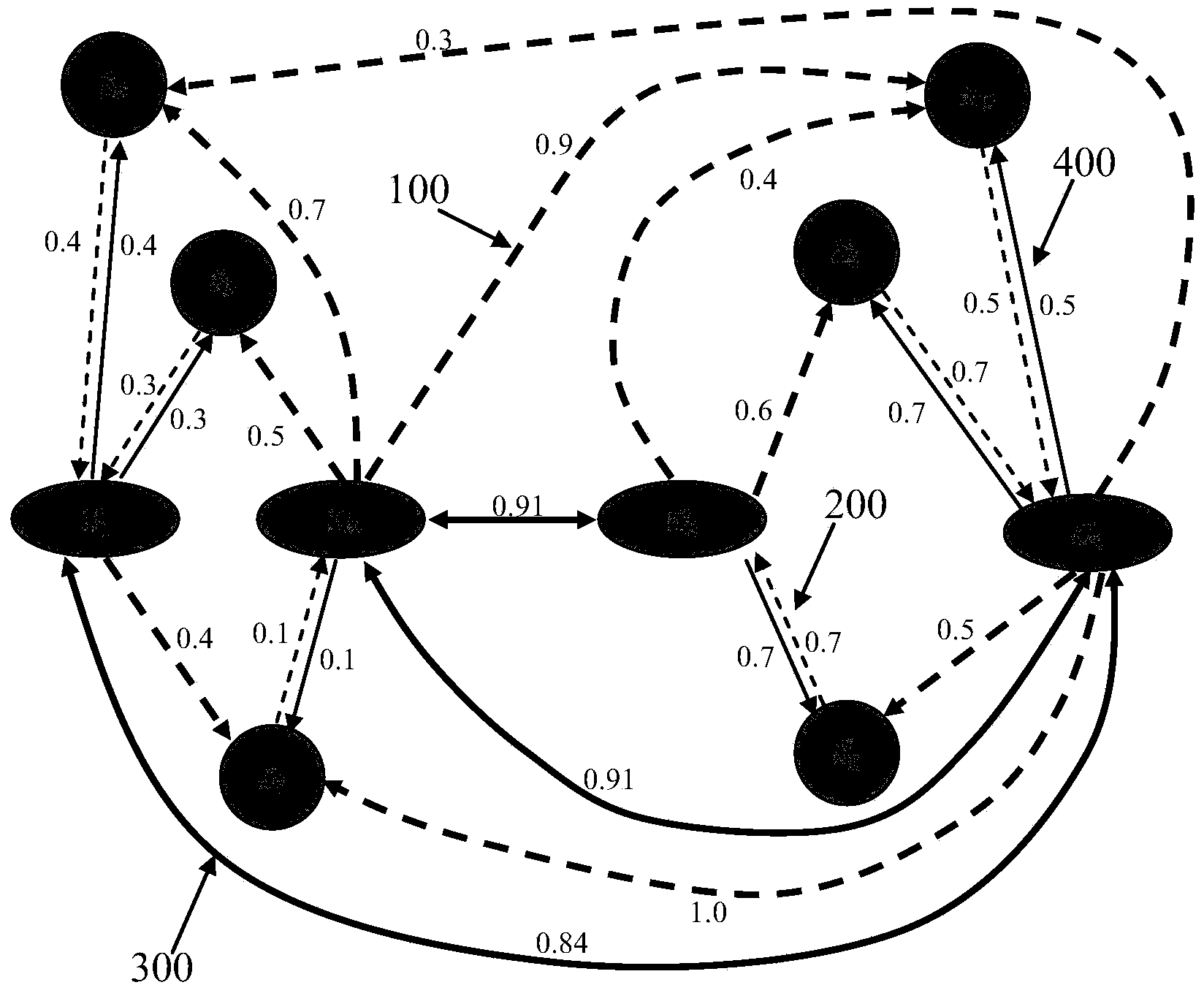

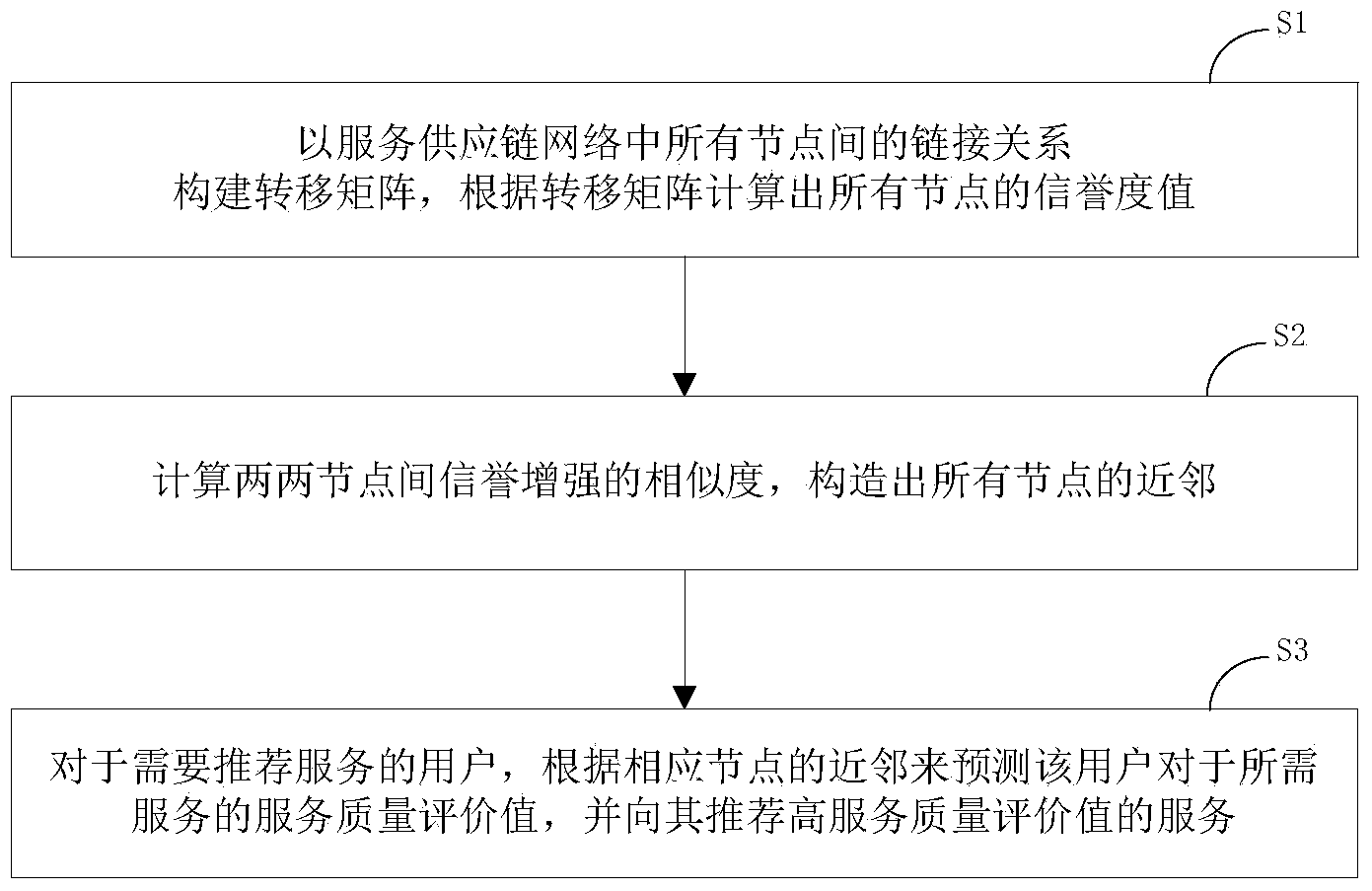

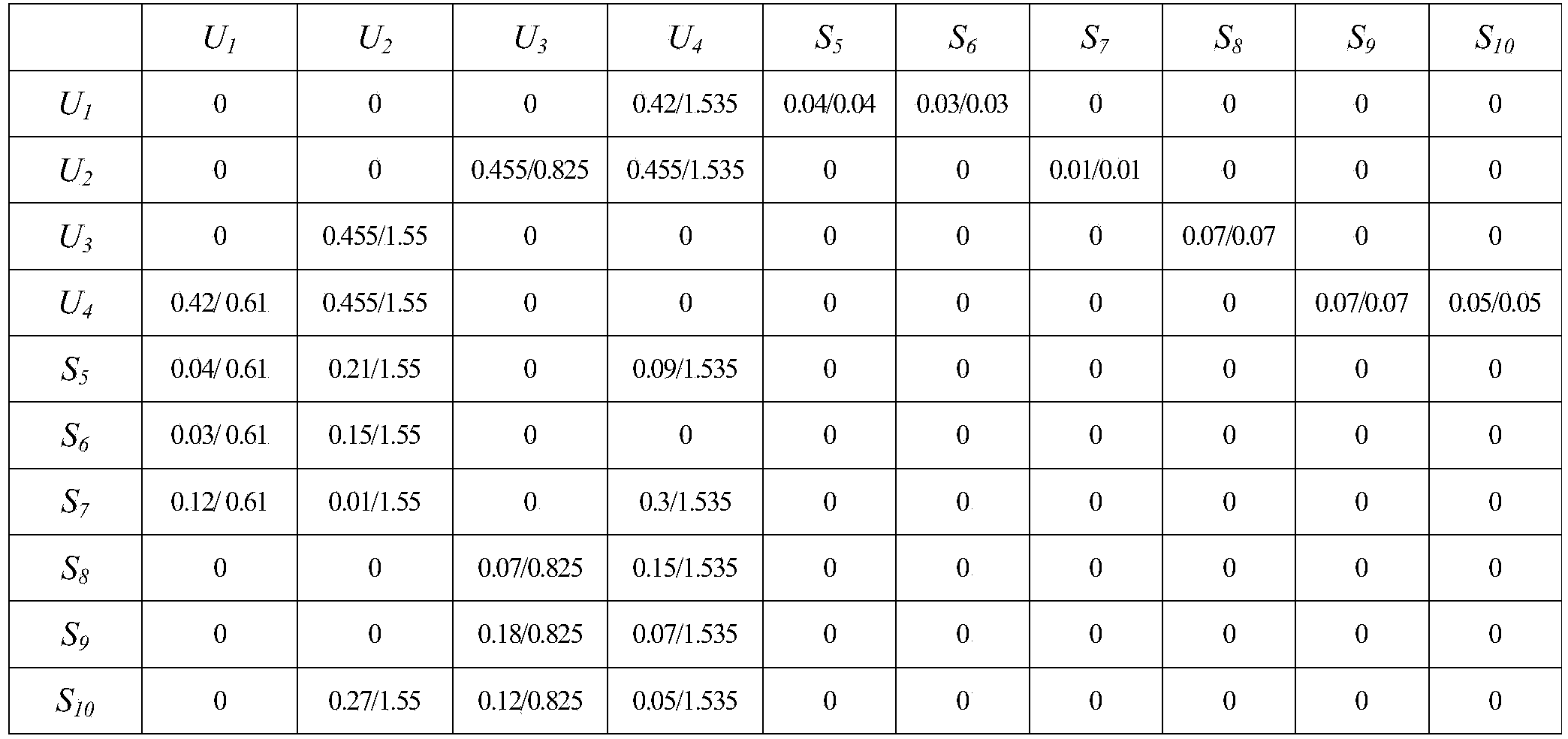

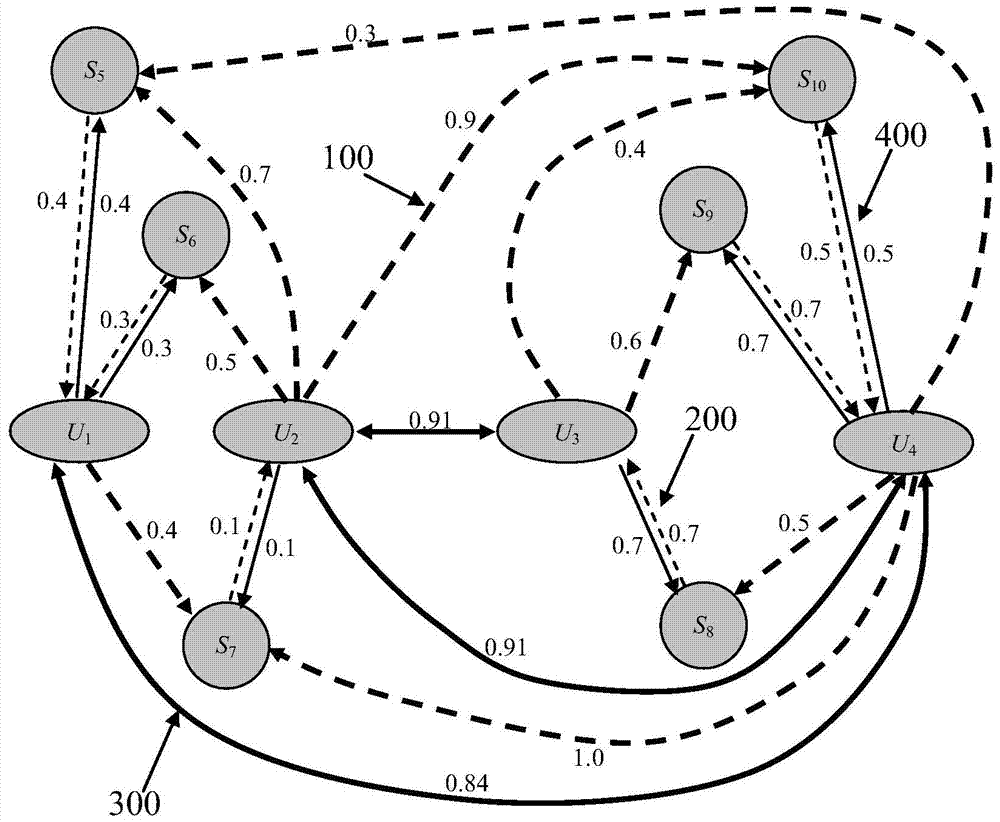

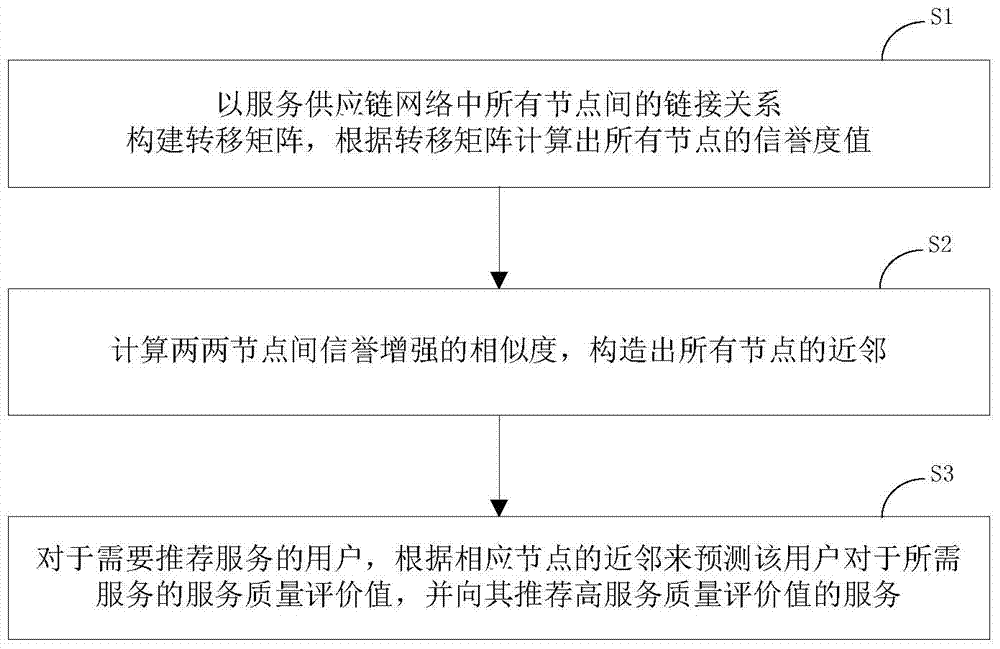

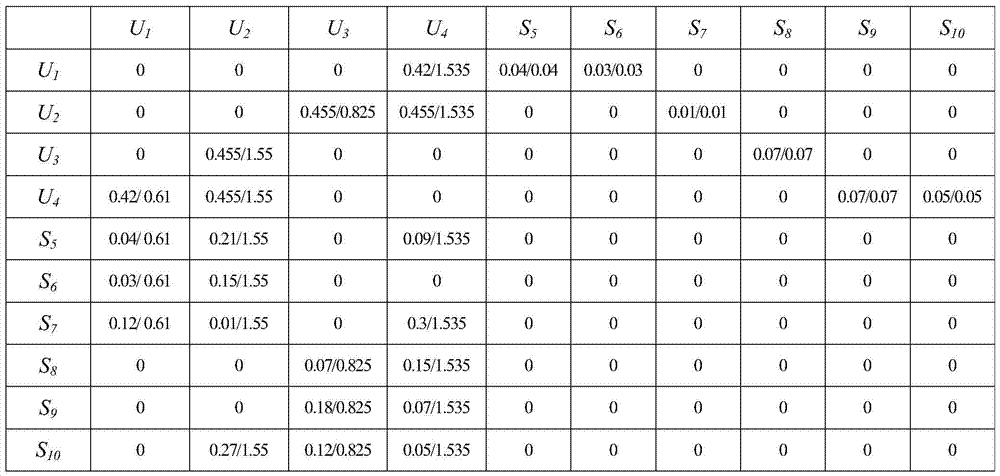

Service recommendation method oriented to service supply chain network

ActiveCN104166702AImprove accuracyData processing applicationsSpecial data processing applicationsUser needsReferral service

The invention discloses a service recommendation method oriented to a service supply chain network. The method includes the steps that firstly, a transfer matrix is established according to the linkage relationship among all nodes in the service supply chain network, and credit values of all the nodes are calculated according to the transfer matrix; then, similarity of credit enhancement between every two nodes is calculated, and neighbors of all the nodes are established; finally, for users needing service recommendation, the service quality evaluation values of services needed by the users are predicted according to the neighbors of the corresponding nodes, and the services with high service quality evaluation values are recommended to the users. By the adoption of the service recommendation method, the service quality evaluation values of the services needed by the users can also be successfully predicted even when historical data are insufficient or the historical data of part of the nodes do not exist, the problems of data sparsity and cold boot in the existing collaborative filtering technology are solved, and service recommendation accuracy is improved.

Owner:ZHEJIANG UNIV OF FINANCE & ECONOMICS

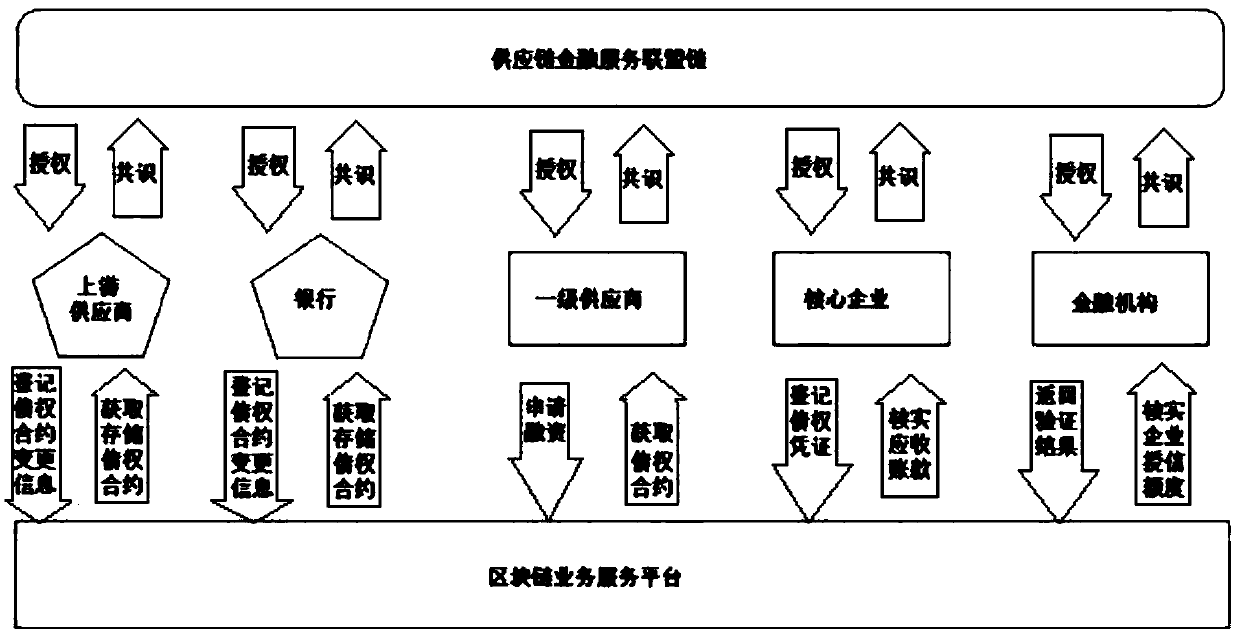

Supply chain finance multi-level credit enhancement method based on a block chain

PendingCN109615510AReduce cooperation costsImprove performance efficiencyFinanceAccounts payableVoucher

The invention discloses a supply chain finance multi-level credit enhancement method based on a block chain, which is characterized by comprising the following steps of: S1, establishing a block chainbusiness service platform of a supply chain financial service alliance chain; s2, dividing different node accounting authorities; s3, obtaining related information of accounts receivable of the coreenterprise; s4, based on an intelligent contract technology, generating a creditor's right certificate according to the receivable account; s5, the owner of the creditor's right voucher finances to the financial institution through the creditor's right voucher, or pays the account payable by the upstream supplier; and S6, after the account receivable time expires, the intelligent contract is triggered, and account transfer of the fixed path is automatically completed. A supply chain financial trust mechanism which does not need trust of all parties is constructed, information can be safely shared, and transaction accounts can be freely transacted. Meanwhile, the concept of creditor's right vouchers is provided, and financing credit of multi-level suppliers is increased. The payment path issolidified through the smart contract, so that the risk can be controlled.

Owner:DALIAN POWER SUPPLY COMPANY STATE GRID LIAONING ELECTRIC POWER +1

Risk-based reference pool capital reducing systems and methods

Embodiments consistent with the present invention provide a credit enhancement structure for risk allocation between parties that minimizes the regulatory capital reserve requirement impact to an institution subject to capital reserve requirement. A subject pool of assets held by the institution, such as a pool of loans, is rated to determine its risk levels. Based on the rated risk levels, a guarantor party agrees to be responsible for a portion of the risk associated with the pool of assets, which may define the maximum risk exposure of the institution holding the asset pool. The risk-rated capital reserve requirements are applied to the asset pool based on the risk level rating and the guarantor's agreed upon risk responsibility such that the institution holds a reduced amount of reserve capital compared to what it would otherwise be required to hold.

Owner:FREDDIE MAC

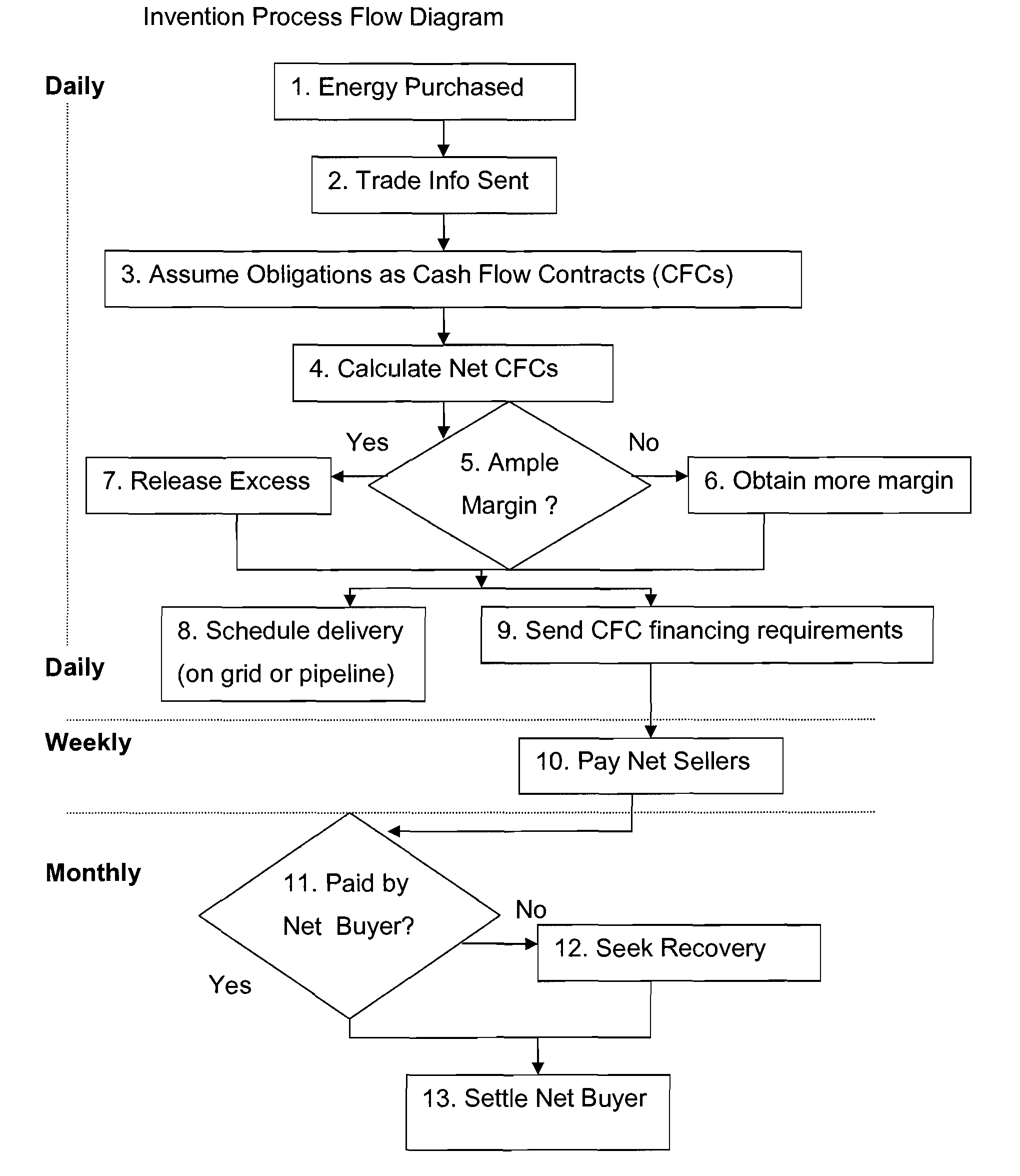

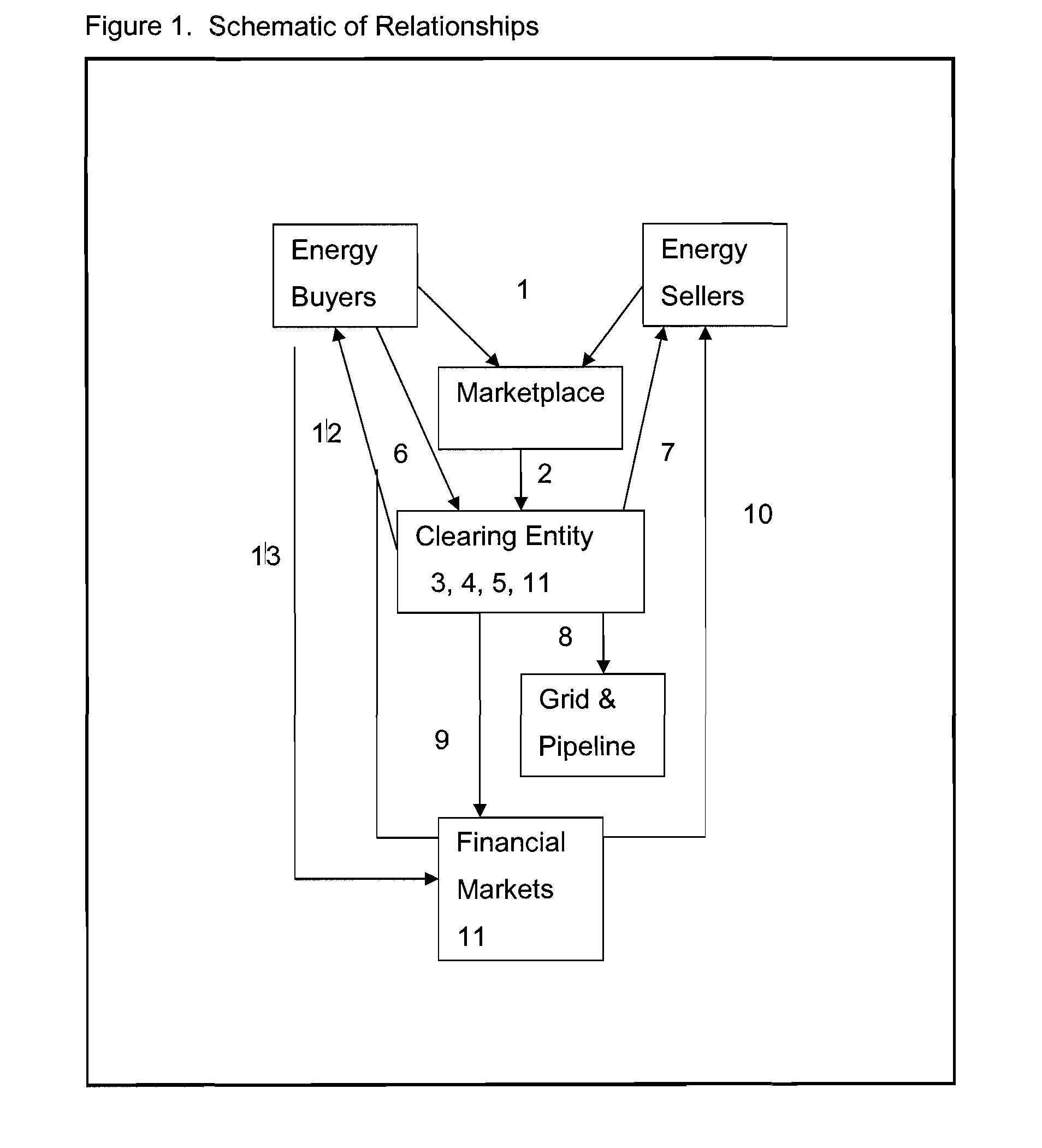

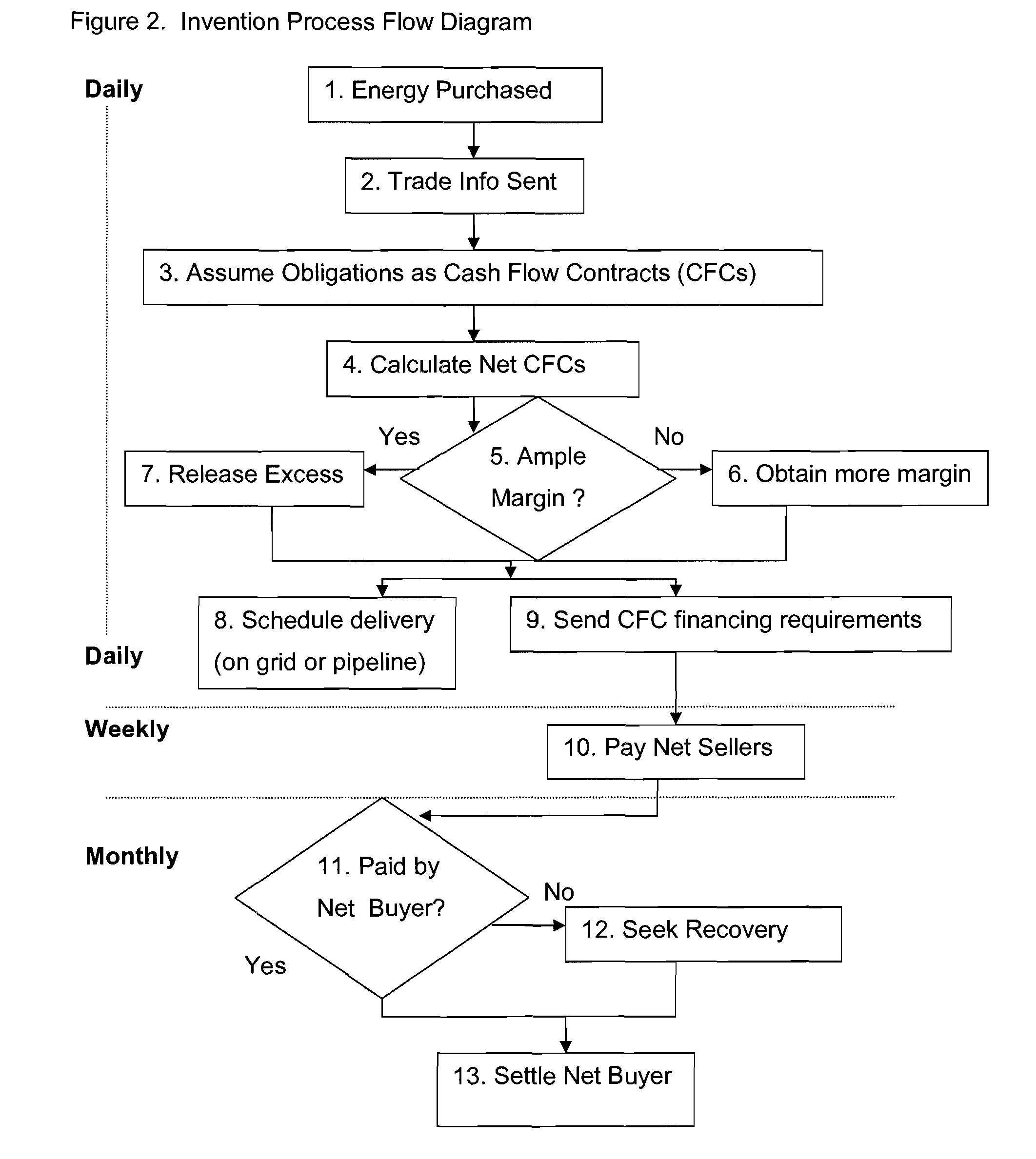

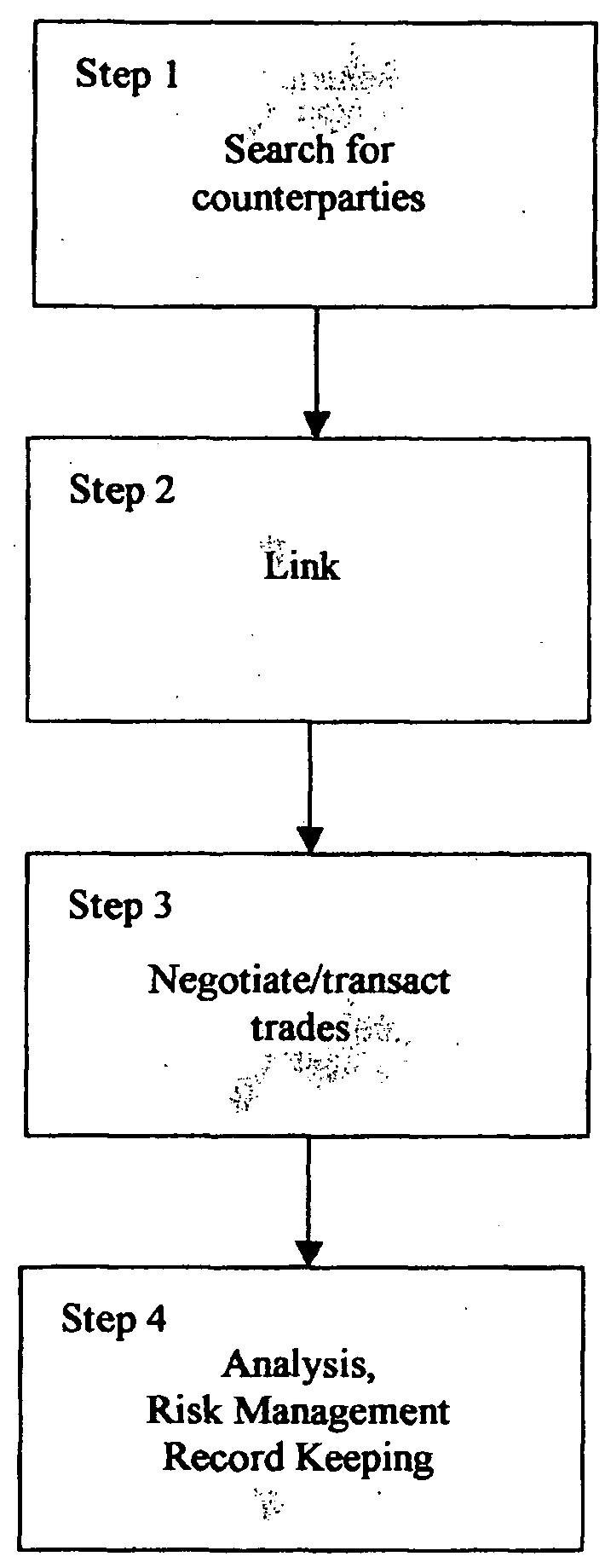

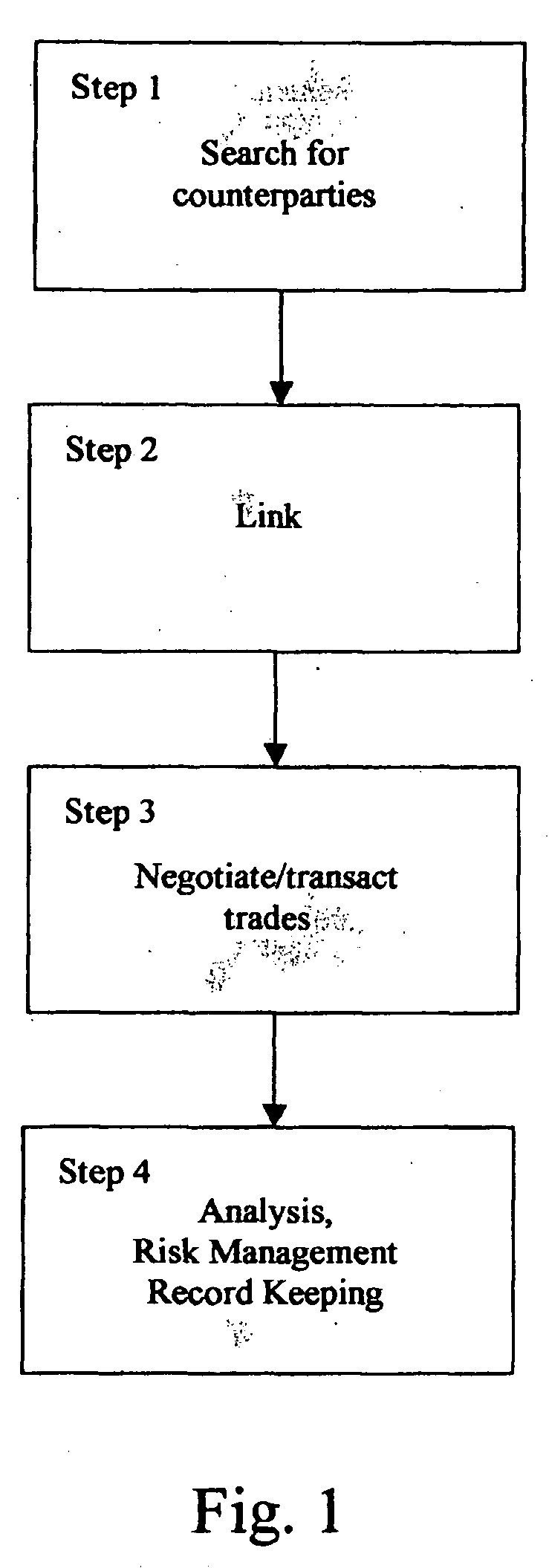

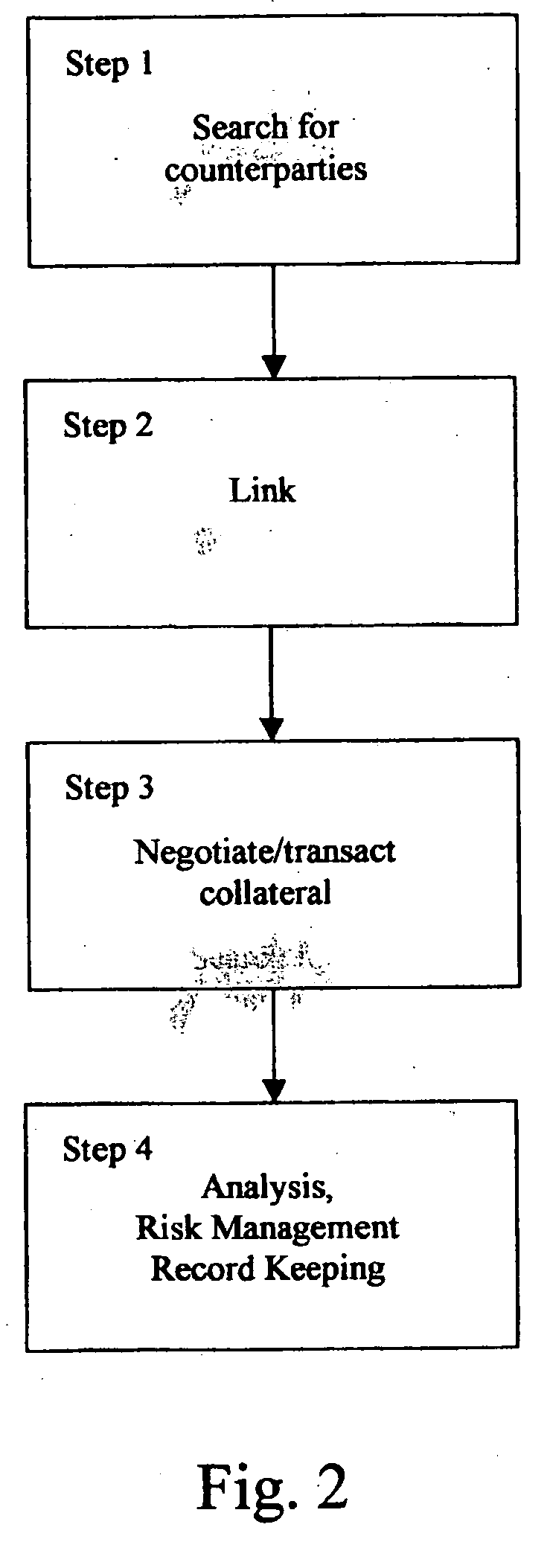

Utilizing Cash Flow Contracts and Physical Collateral for Energy-Related Clearing and Credit Enhancement Platforms

In accordance with the present invention, a financial instrument for the energy market is created. The financial instrument comprises a derivative instrument related to accounts receivable or accounts payable or both. In a preferred embodiment, the derivative instrument normally consists of two sets of linked swaps. In the first set, the seller exchanges two things with a third party: (i) the right for payment of accounts receivable within a month from the buyer is exchanged for the right to payment of such accounts receivable within a week from the third party; and (ii) the obligation to deliver energy to the buyer is exchanged for the obligation to deliver to the third party. The buyer exchanges the mirror image of those with a third party, to with: (i) the obligation to pay within a month to the seller is exchanged for the obligation to pay within a week to the third party, but the buyer receives financing to offset the cash flow ramifications; and (ii) the obligation to take delivery from the seller is exchanged with the obligation to take delivery from the third party. The swap can further be utilized to net payment obligations under multiple cash and forward commodity transactions between the buyer and the seller. Physical collateral is utilized as margin. In accordance with another aspect of the present invention, the process takes place on a ‘clearing platform’ for such energy transactions.

Owner:NASDAQ INC

Risk-based reference pool capital reducing systems and methods

Embodiments consistent with the present invention provide a credit enhancement structure for risk allocation between parties that minimizes the regulatory capital reserve requirement impact to an institution subject to capital reserve requirement. A subject pool of assets held by the institution, such as a pool of loans, is rated to determine its risk levels. Based on the rated risk levels, a guarantor party agrees to be responsible for a portion of the risk associated with the pool of assets, which may define the maximum risk exposure of the institution holding the asset pool. The risk-rated capital reserve requirements are applied to the asset pool based on the risk level rating and the guarantor's agreed upon risk responsibility such that the institution holds a reduced amount of reserve capital compared to what it would otherwise be required to hold.

Owner:FREDDIE MAC

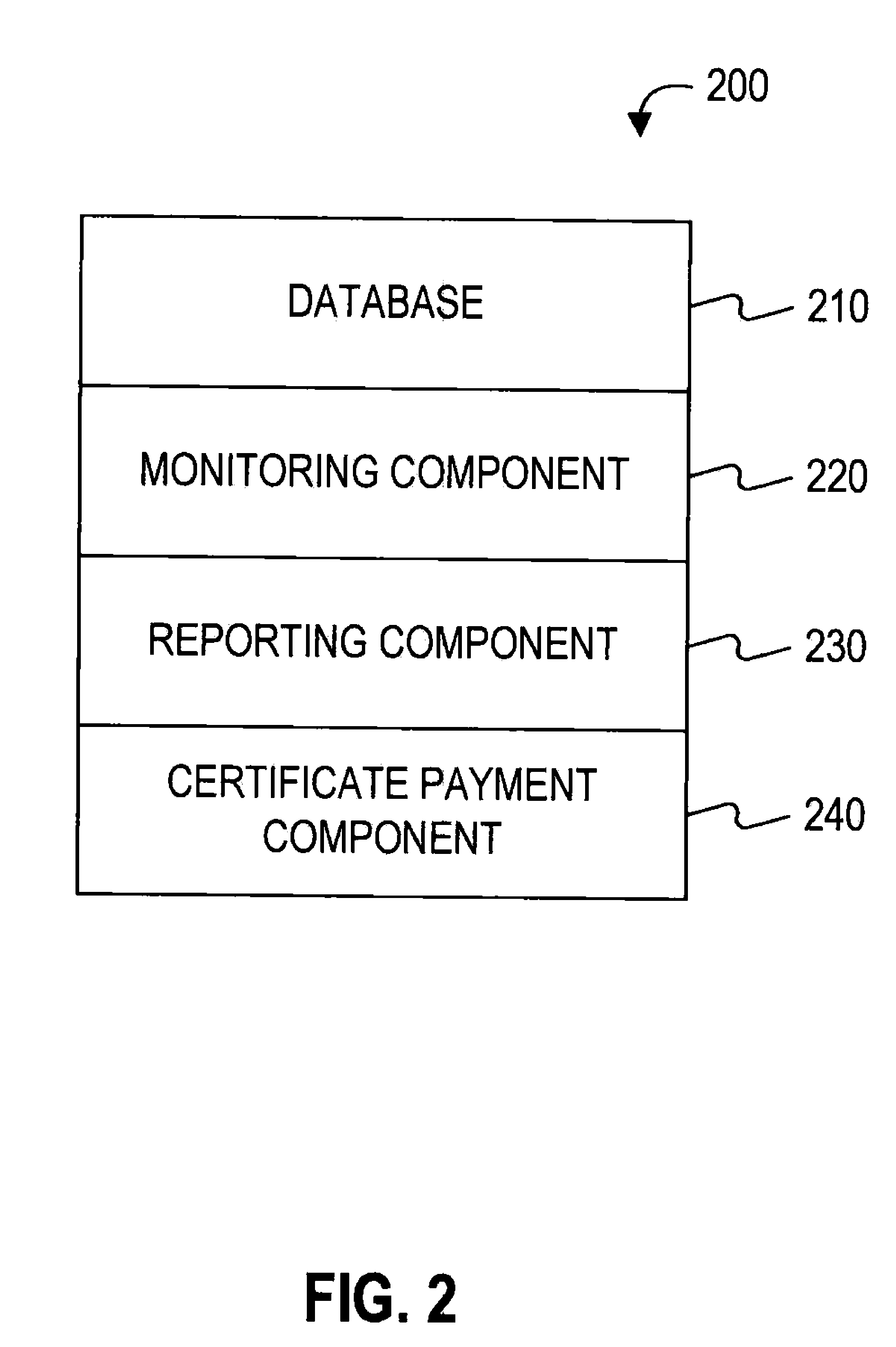

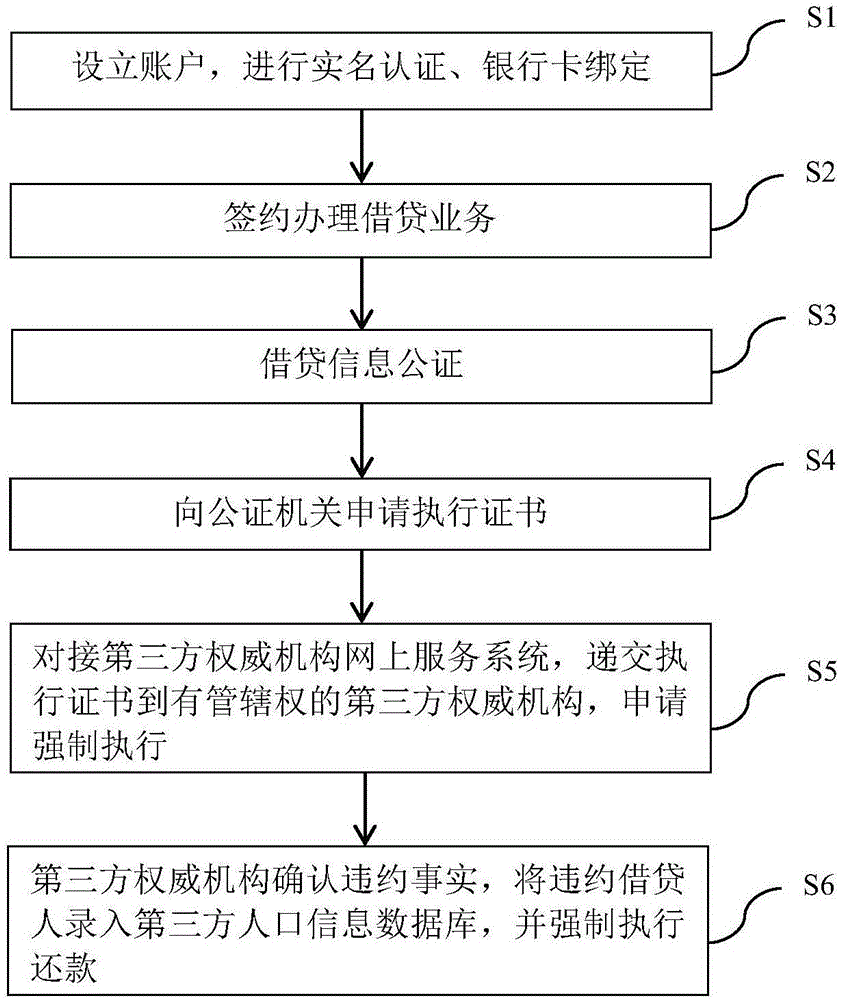

Internet financial debit and credit management system and method

The invention provides an Internet financial debit and credit management system and method, which belong to the field of information technology. Through operation of an electronic account opening and signing unit, an electronic data storage unit and a notary office inspection unit under the Internet financial debit and credit management system, the Internet financial debit and credit management method is fully applied to Internet financial management in order to make debit and credit information evidence preserved in time, realize online compulsory enforcement notarization and reduce the difficulty of money collection after loan. Meanwhile, because the default information of dishonest borrowers is input to a third party population information database, the default cost of dishonest borrowers is increased, and certain deterrence can be produced to urge borrowers to make repayment actively. Therefore, through the system and the method, the problem of overdue loans and difficult post-loan disposal in the process of Internet financial operation and management can be solved, and the construction of the Internet financial management system can be promoted.

Owner:杭州云证网络科技有限公司

Scoring method and system for reflecting enterprise health management, financing and credit enhancement

The invention discloses a scoring method and system for reflecting enterprise health management and financing credit enhancement. The scoring method comprises the following steps: S2, carrying out data verification on application data; S4, when the data is qualified through verification, performing model evaluation on the data; S6, when the data passes model evaluation, manual auditing is carriedout; and S8, when the data passes the manual audit, passing the overall audit. The credit loan evaluation characteristics of the small and micro enterprises are cognized by combining a bank institution and a non-bank institution, health management and financing credit increase of the small and micro enterprises are comprehensively evaluated by combining technical means of big data and machine learning, and a scoring model is quantized, so that the financing problem of the small and micro enterprises is better solved.

Owner:CHANJET INFORMATION TECH CO LTD

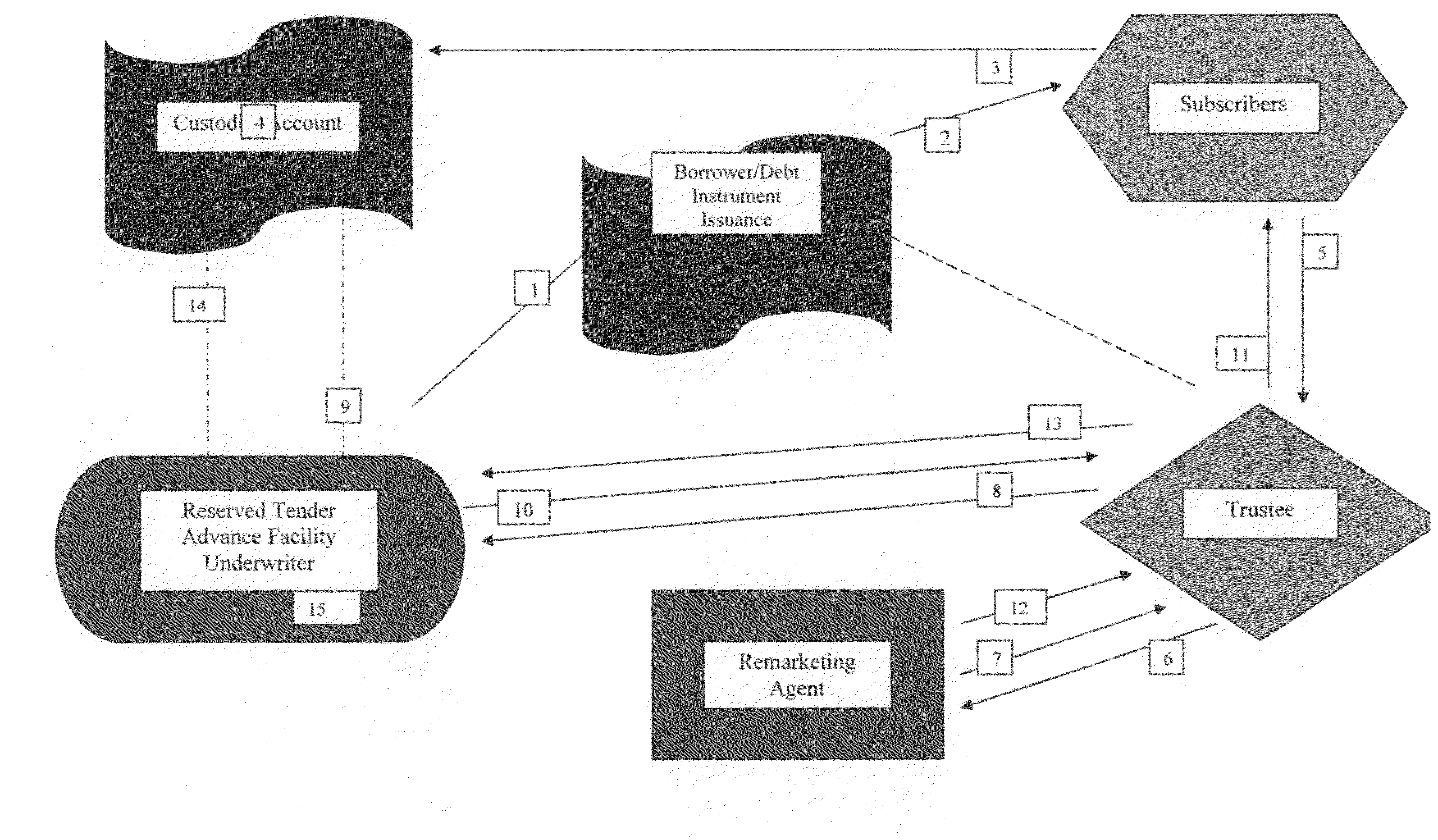

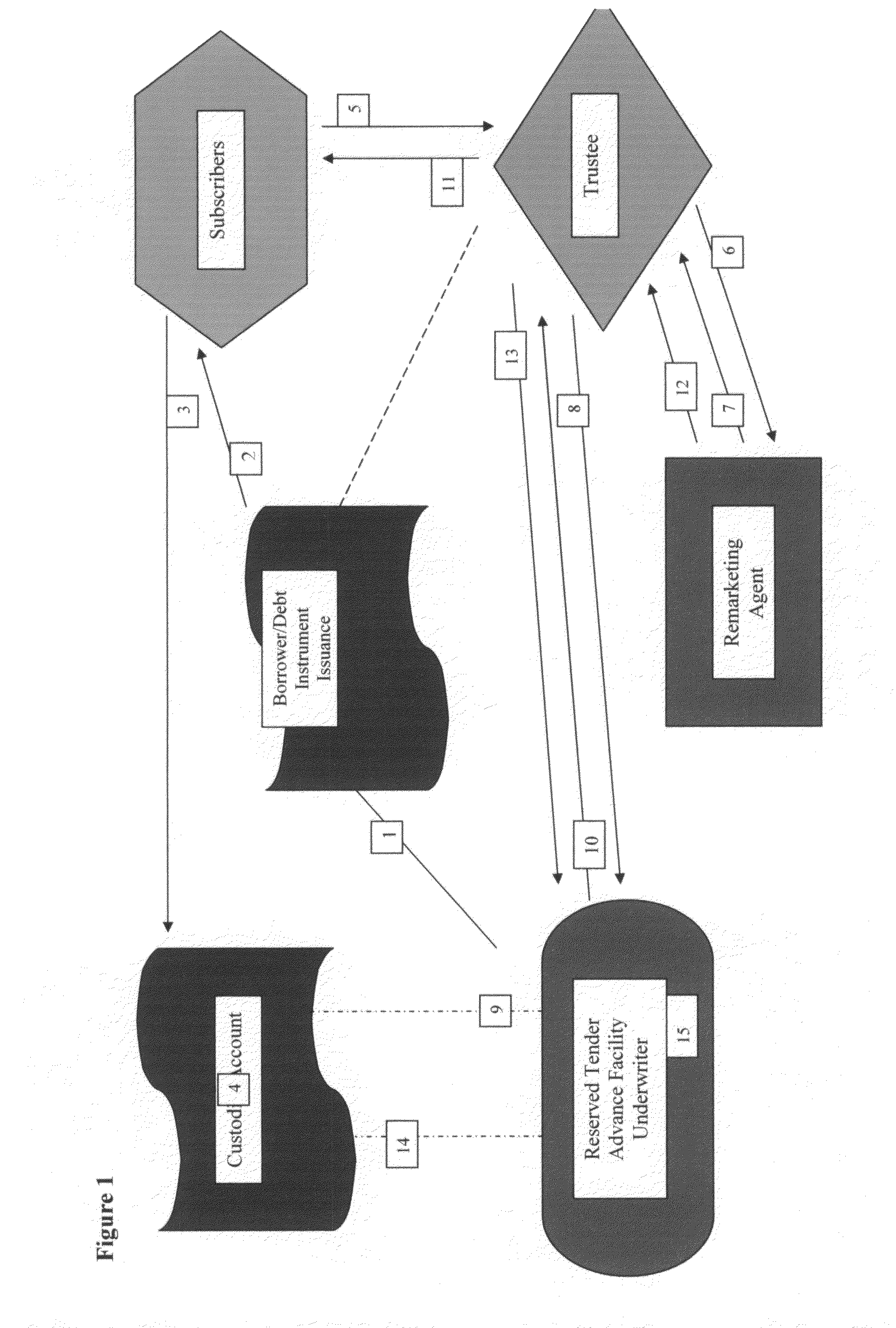

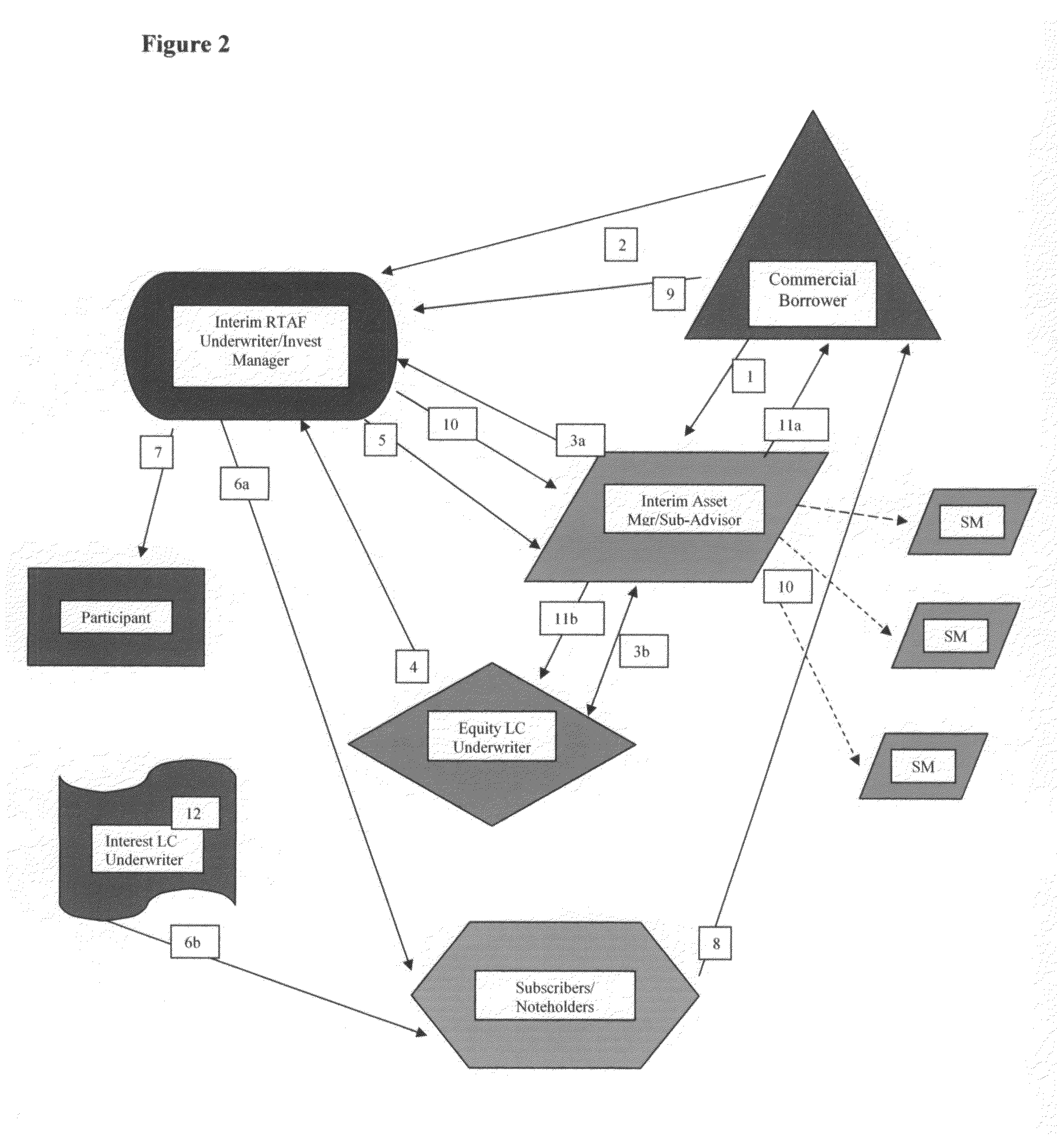

Reserved tender advance facility

A financial process in accordance with the principles of the present invention enables an amount of financing instruments to be credit enhanced. A reserved tender advance facility is established for an aggregate value minimally equal to the principal amount of debt to be undertaken. The reserved tender advance facility may be supplemented for first-loss or principal risk by the delivery of equity either in cash or in the form of an equity letter of credit. The reserved tender advance facility is maintained on standby until such time as a drawing made there under is received. Financing instruments, in reliance upon the credit-worthiness of reserved tender advance facility provider, are sold to eligible investors. Proceeds from the sale of the financing instruments are deposited in at least one account from which the proceeds will be invested in eligible investments. When a tender of the financing instruments is received, financing instruments obligation are directed for satisfaction of the tender and the financing instruments are remarketed for repurchase prior to the tender settlement date. In the event of a shortfall of remarketing proceeds, the reserved tender advance facility is drawn for the value of the shortfall.

Owner:MARIAM SYST

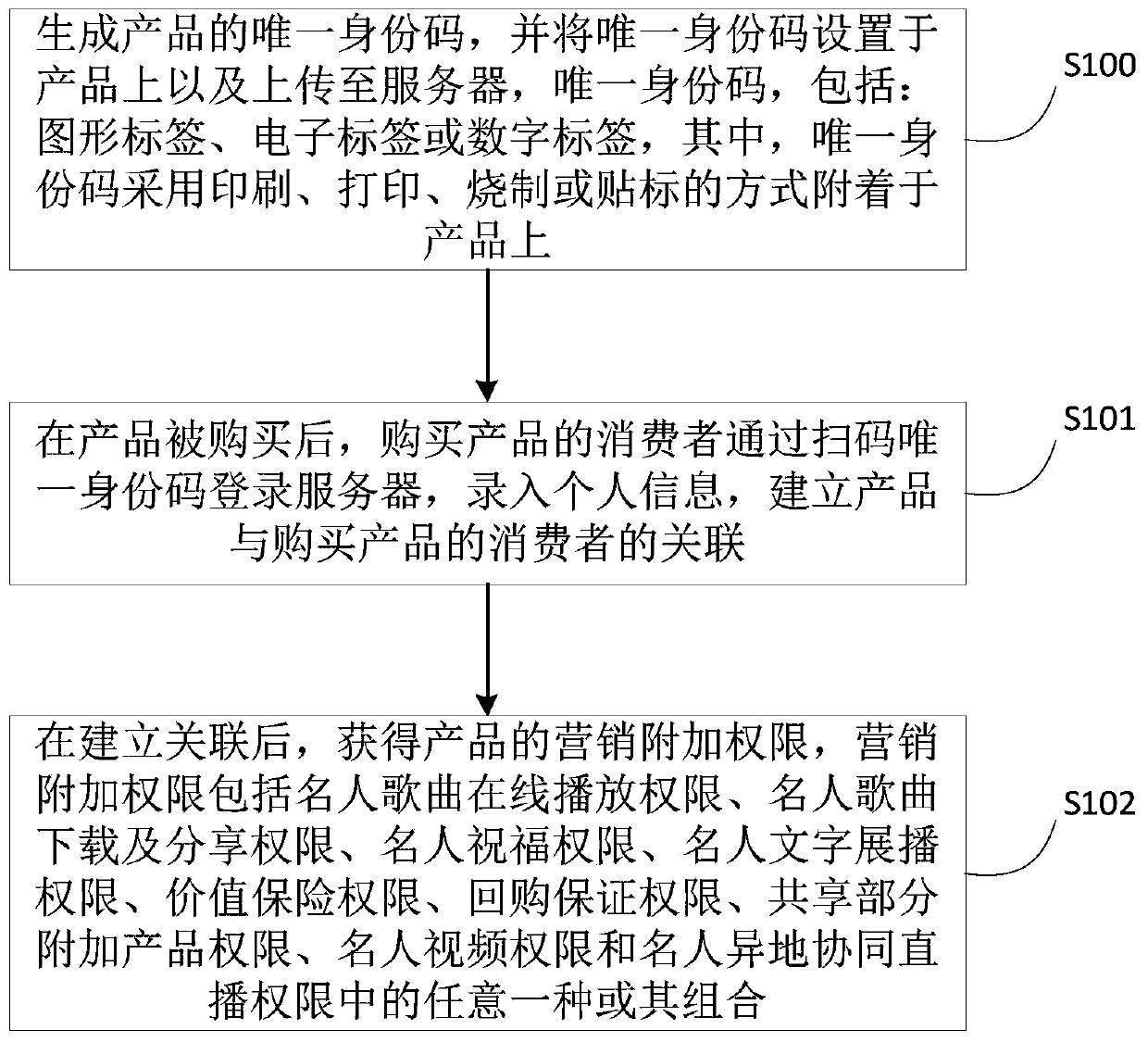

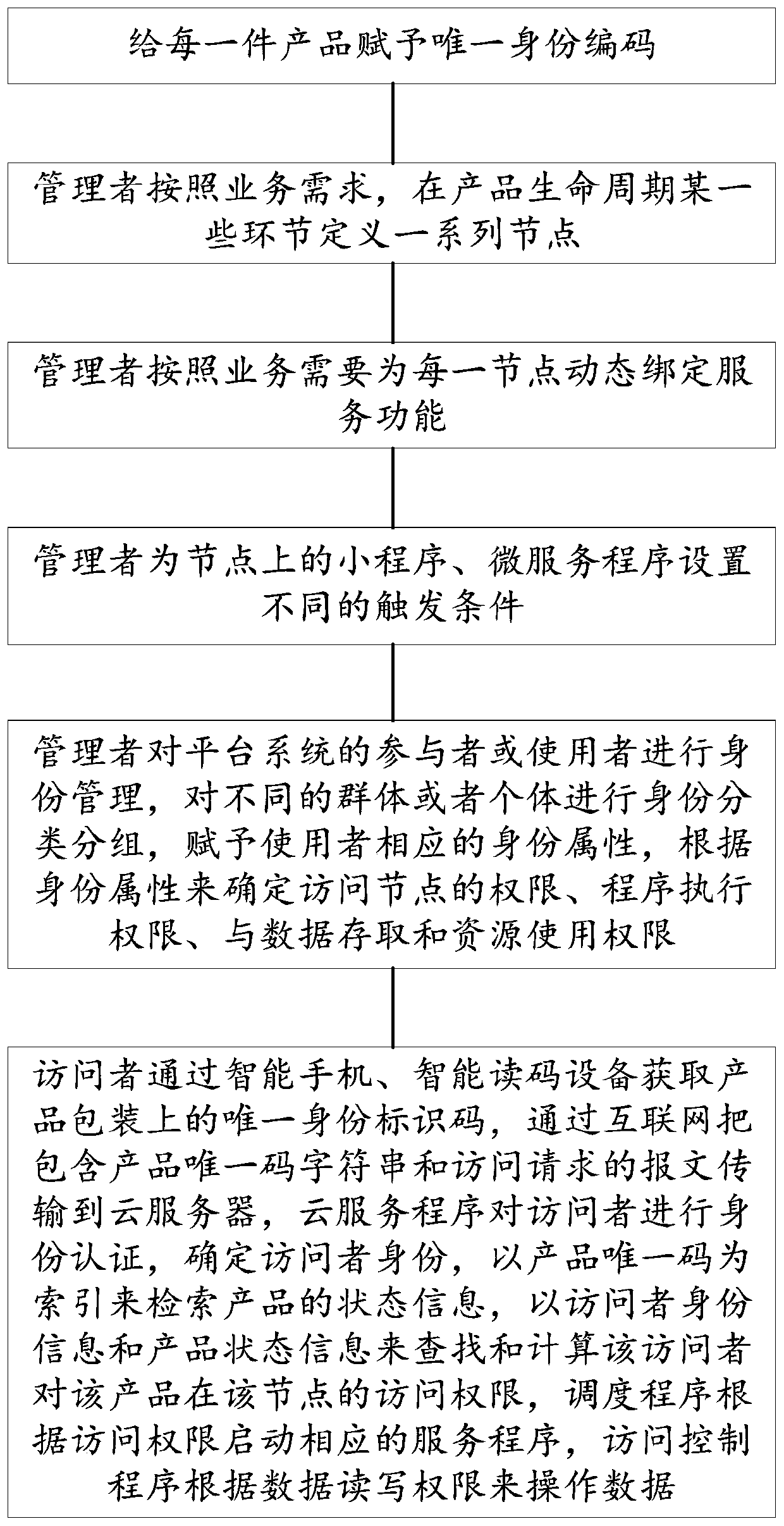

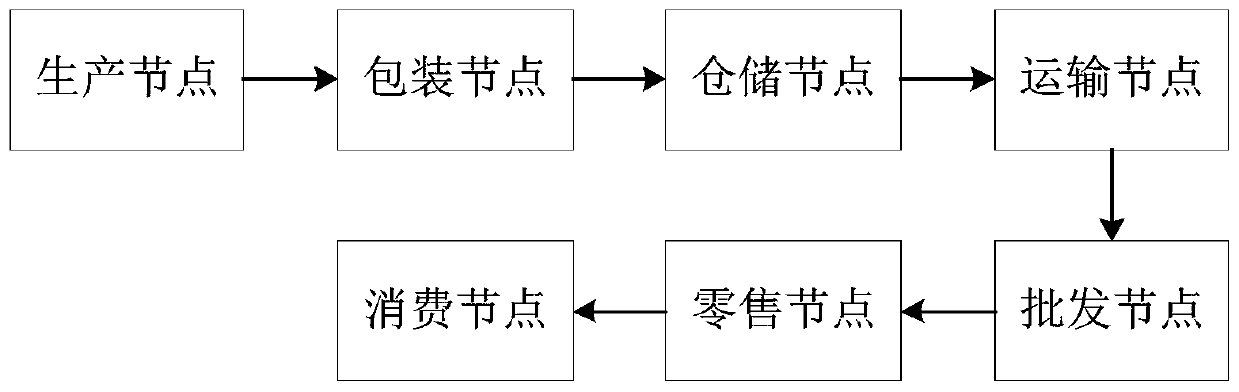

Internet marketing method

ActiveCN110322269AIncrease the lengthPrecision marketingDiscounts/incentivesDigital data protectionInformation sharingDynamic resource

The invention provides an internet marketing method. An economical and applicable intelligent marketing management system integrating product credit enhancement, intermediate business dynamic enabling, business chain extension, sales scene extension and multi-industry fusion is constructed by an identity authentication technology, a unified coding technology, a dynamic node configuration method, dynamic resource configuration, dynamic authority distribution and a runtime service program binding technology method. According to the internet marketing method, a unique identity identification codeis given to a product; different functions and meanings are given to the identity identification code according to various states of the product in the life cycle; the management and service requirements in the current state are met in a targeted manner; the personalized service is automatically presented along with the application scene; each user can set information service nodes and bind information service functions according to needs, integrate and configure resources according to needs, dynamically endow the nodes with resources and capabilities, and drive resource allocation and upstream and downstream cooperation and full-chain information sharing of each intermediate link according to operation needs, so that the operation efficiency and benefits are improved.

Owner:CHENGDU CYBERKEY TECH

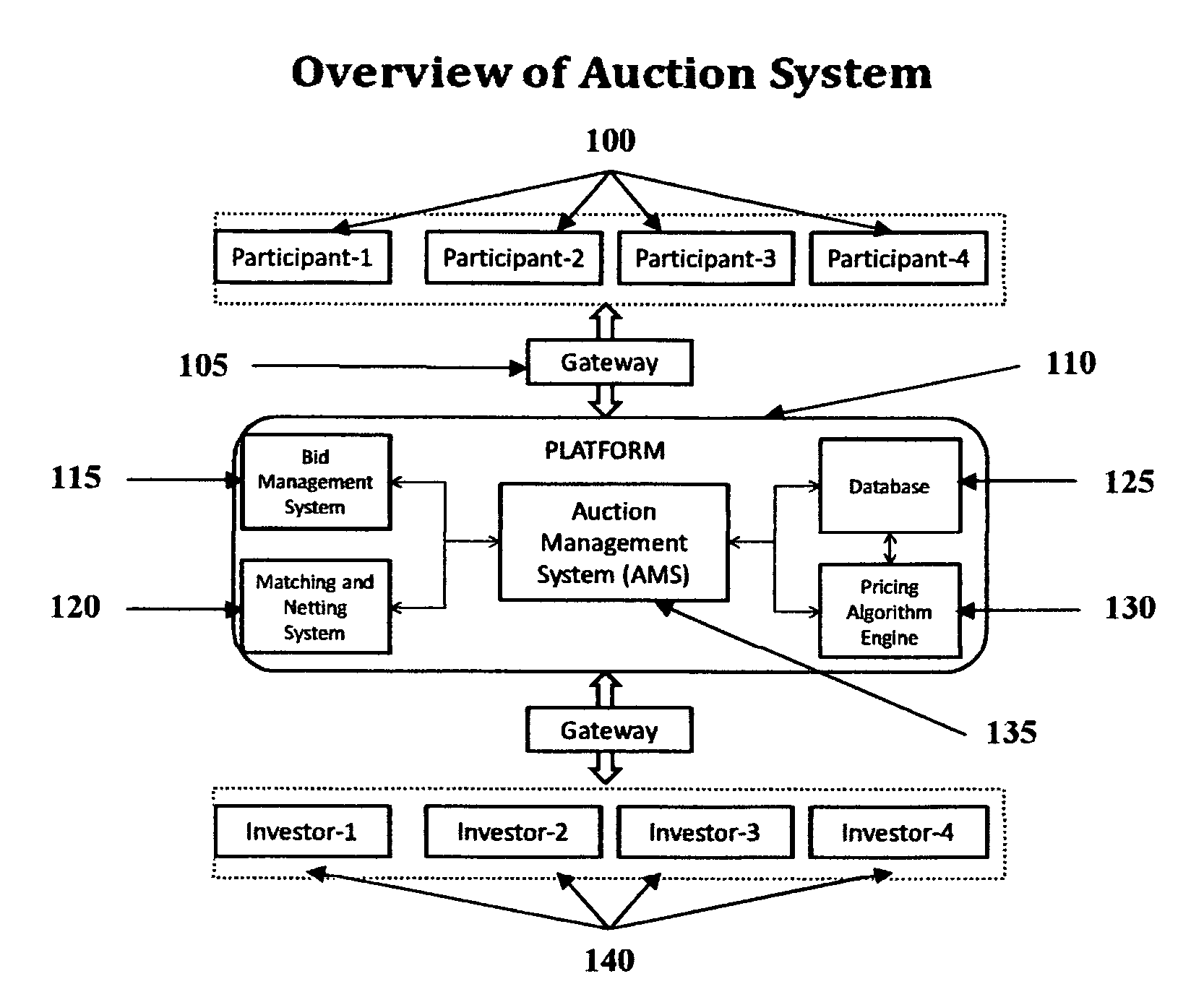

System and method for credit enhancing a debt issuance and creating a present value investable arbitrage

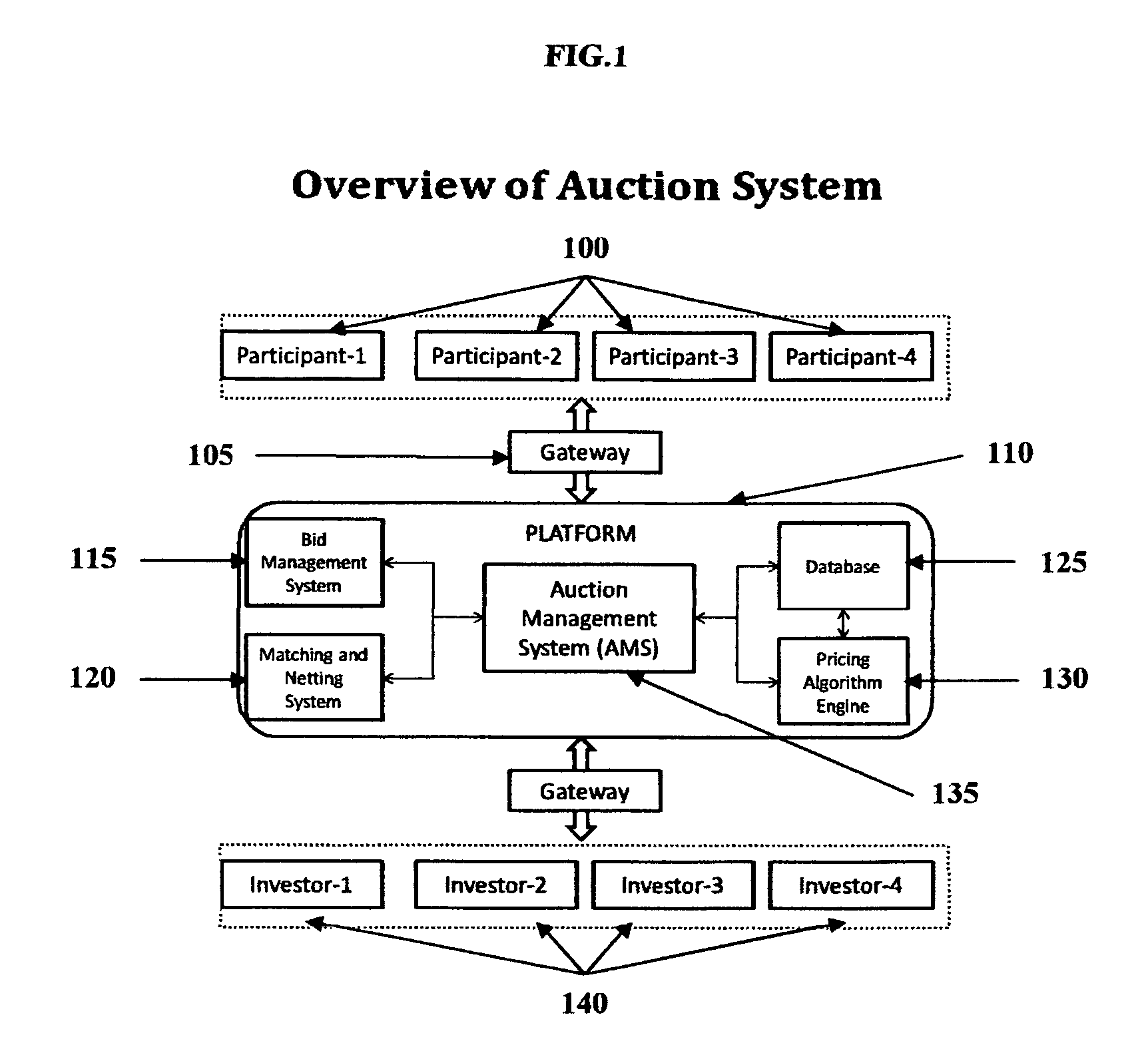

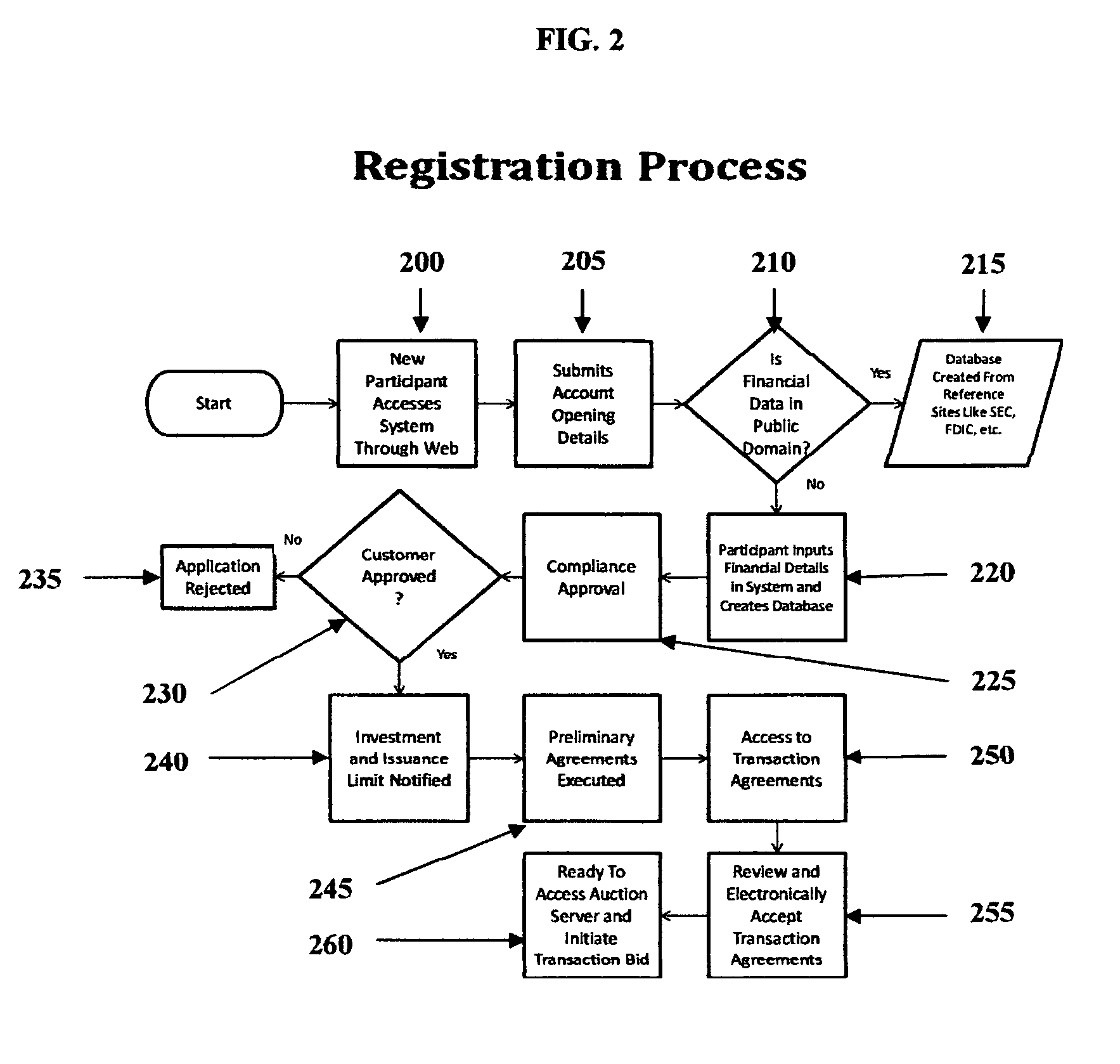

The debt issuance of a company are credit enhanced via an investment platform wherein the company's issuances and investments are both subject to a master netting agreement between common counterparties, thereby creating a fully hedged transaction with an investible present value monetization of the future income stream for purposes of reinvesting. The Investment Platform comprises a proprietary Cross Settlement, Credit Enhancement, Risk-Mitigation and Netting System that has a hedged investment structure that automatically qualifies for credit enhancement wherein non-investment grade debt issuances can be transformed into investment grade debt issuances. The Investment Platform is powered by a proprietary investment algorithm and make-whole algorithm that matches movements in a selected benchmark rate or indices. It provides a matched supply of capital to reinvest as the core of the structure recycles the investment capital by a method of monetizing the future income stream, while simultaneously matching and hedging the investment.

Owner:ROSSI STEPHEN EDWARD +1

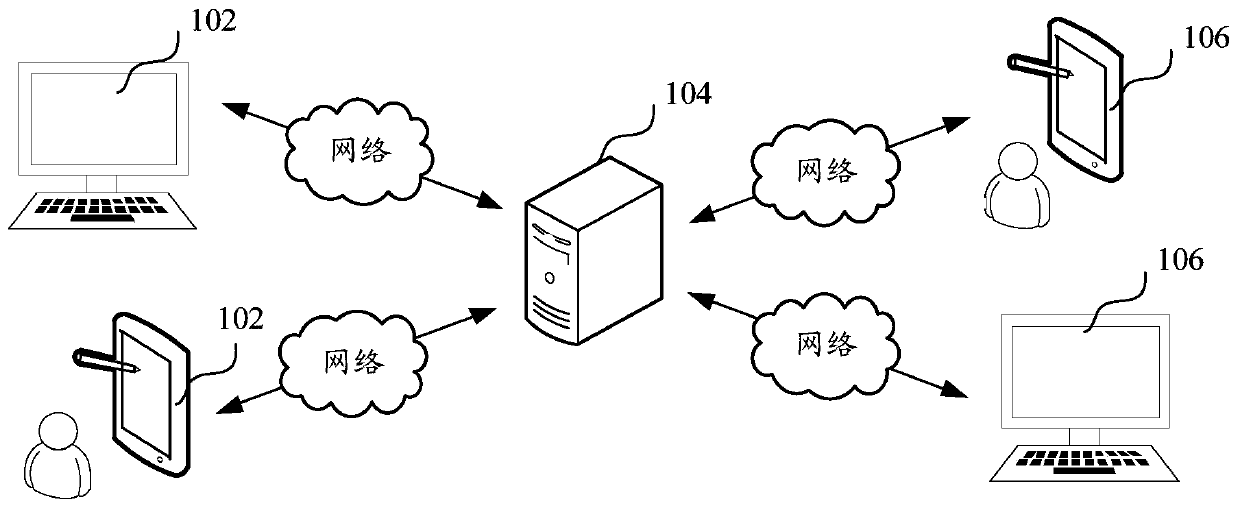

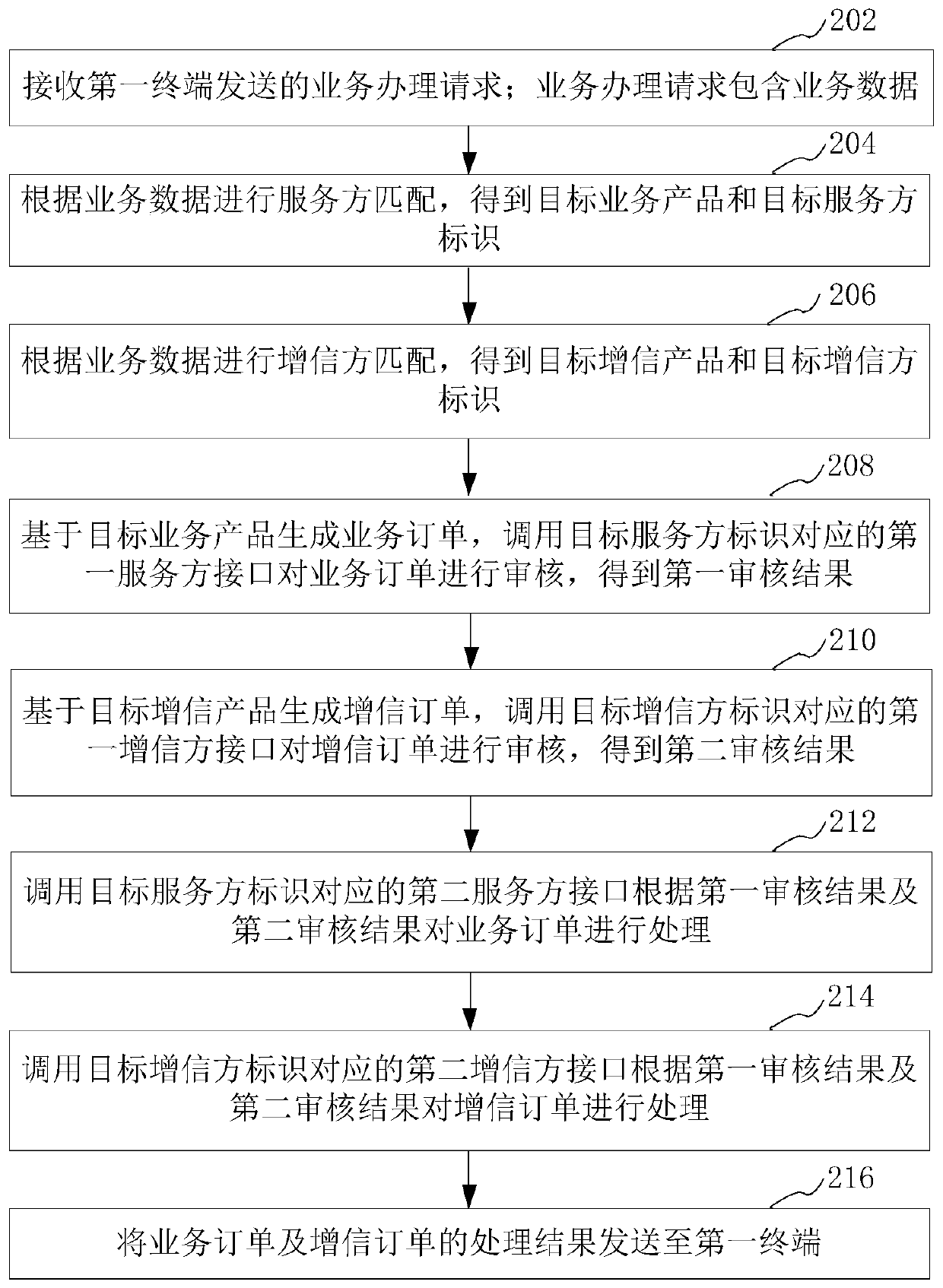

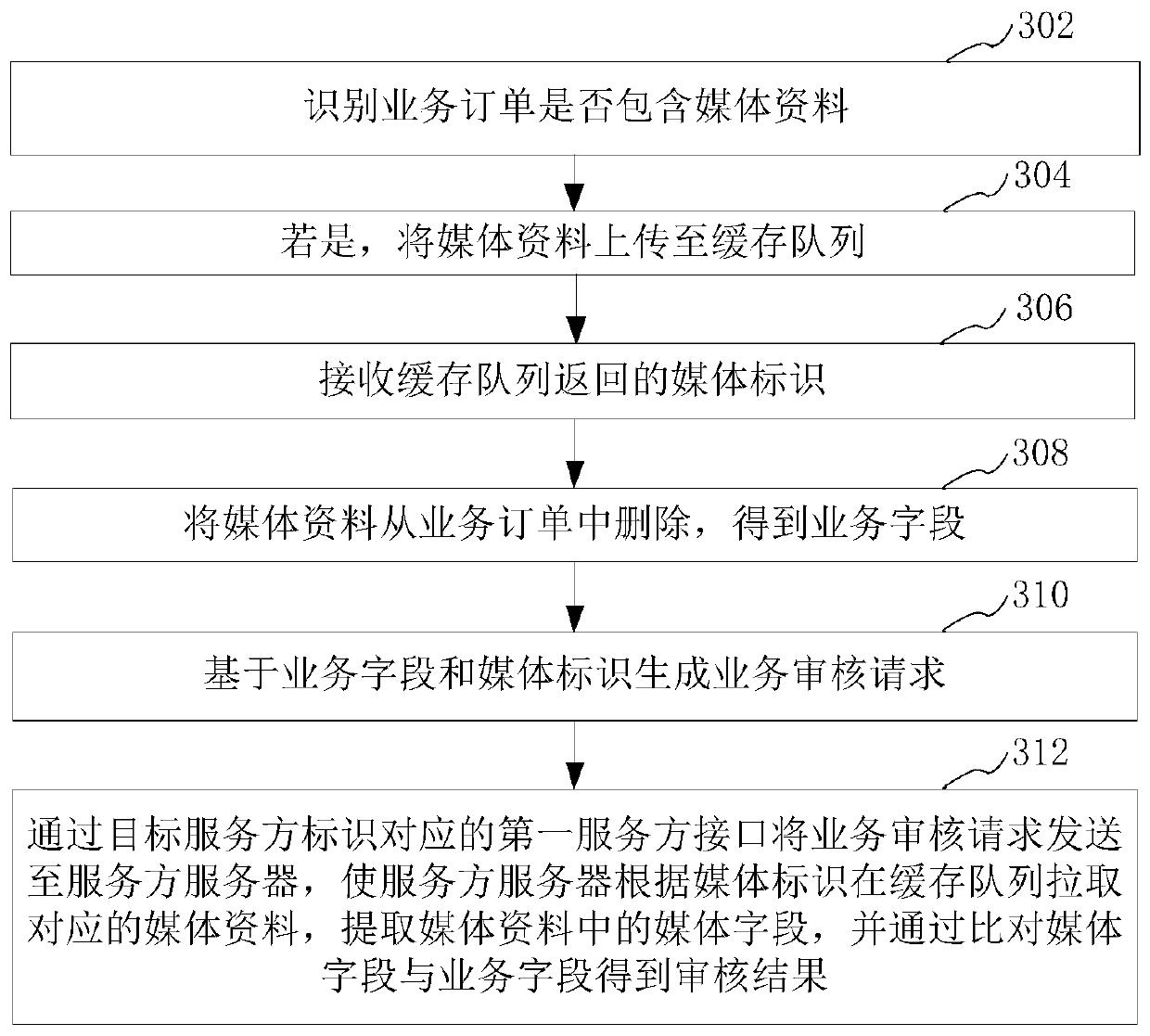

Business processing method and device based on credit enhancement, computer equipment and storage medium

PendingCN109816517AImprove response efficiencyReduced development effortFinanceBusiness dataComputer terminal

The invention relates to a business processing method and device based on information increase, computer equipment and a storage medium. The method comprises the following steps: determining a corresponding target business product, a target server identifier, a target credit product and a target credit identifier according to business data sent by a first terminal; generating a business order based on the target business product, and calling a first service party interface corresponding to the target service party identifier to audit the business order to obtain a first auditing result; generating a credit increasing order based on the target credit increasing product, and calling a first credit increasing party interface corresponding to the target credit increasing party identifier to check the credit increasing order to obtain a second check result; calling a second service party interface corresponding to the target service party identifier to process the business order according to the first audit result and the second audit result, and calling a second credit increasing party interface corresponding to the target credit increasing party identifier to process the credit increasing order; And sending the processing result to the first terminal. By adopting the method, the service processing efficiency can be improved.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

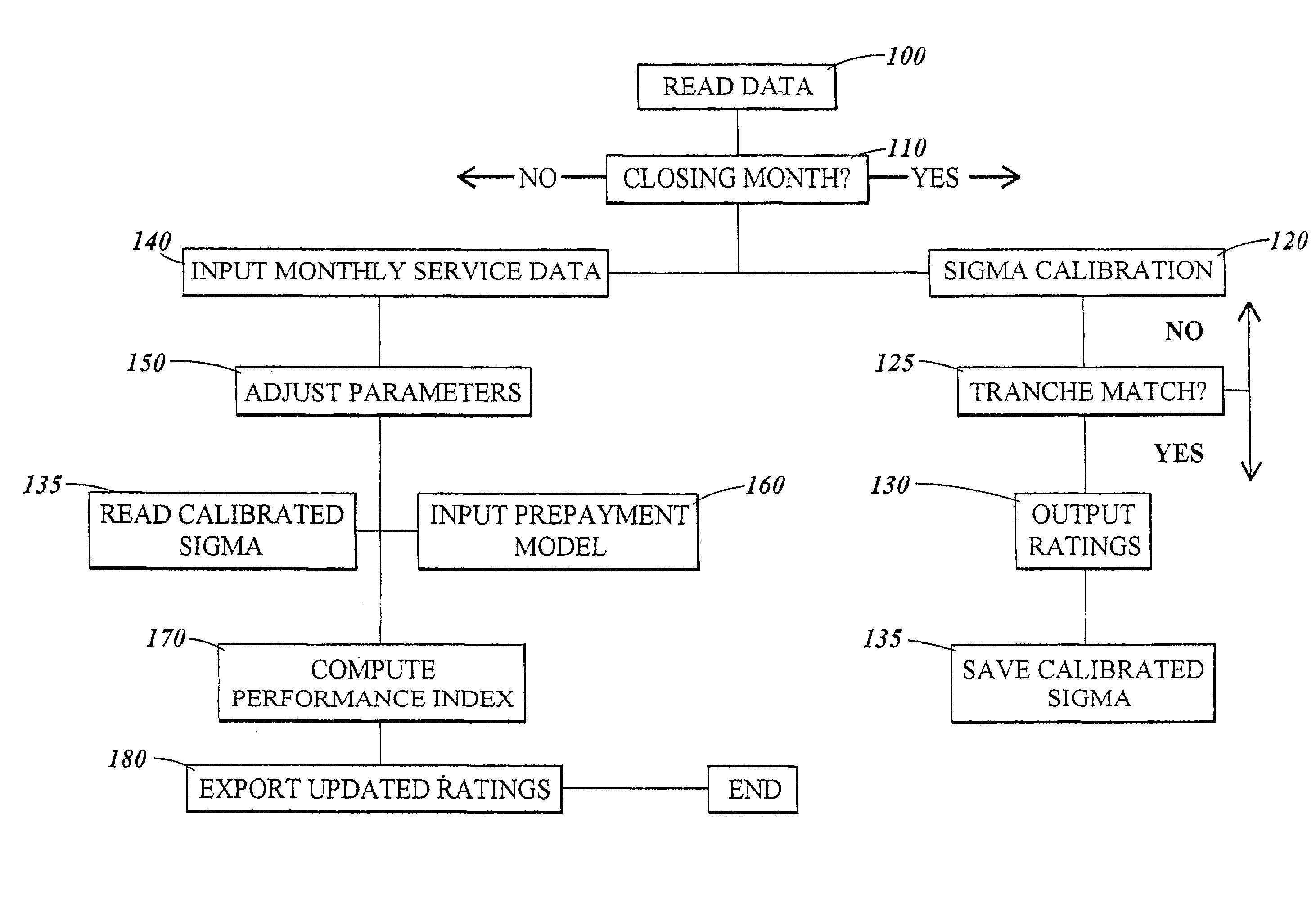

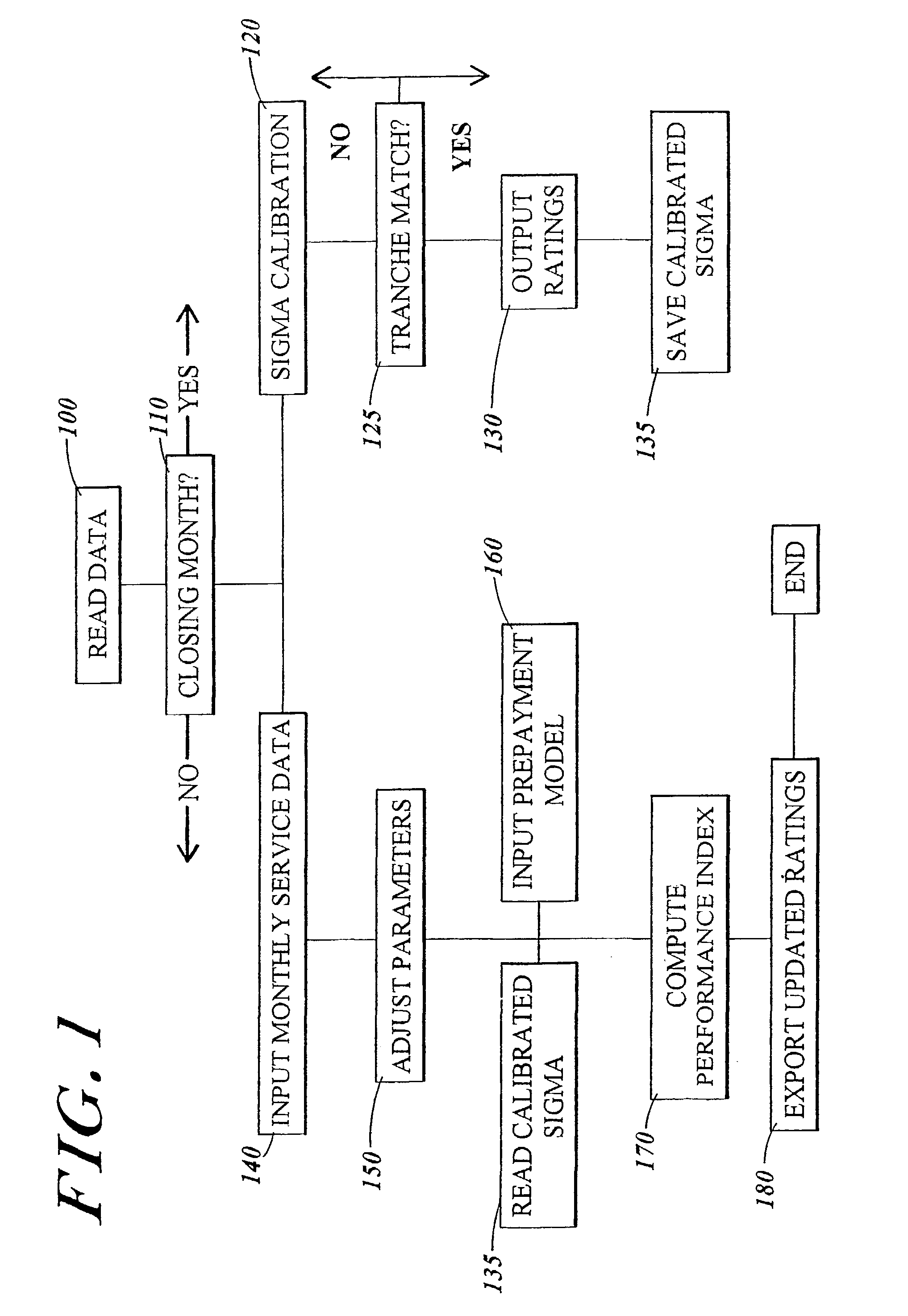

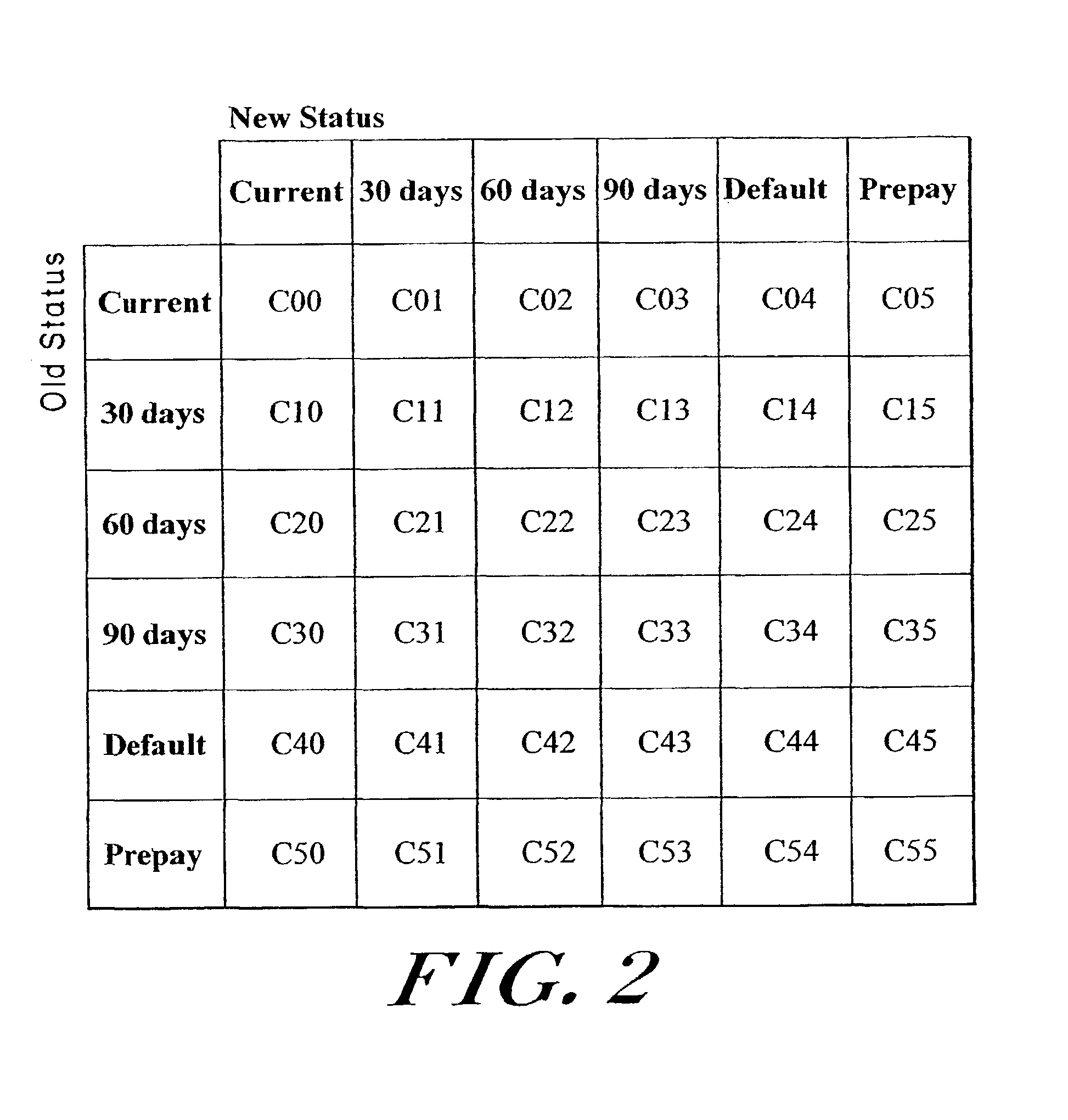

Structured finance performance monitoring index

A method for assessing and dynamically rating transactions (180) for structured finance transactions. The method assesses the deviation (170) from a payment promise to be expected from securities backed by pools of assets of various forms (100), the securities being issued in a plurality of tranches (125). The liabilities of the transaction, including triggers and external form of credit enhancement, are taken into account precisely to compute the deviation from the payment promise to be expected by liability holders. Data representing the structure of the transaction and the current state of the asset pool are received (100). A Markov chain formalism (150) is applied on the received data, and a cash flow model is constructed to predict the cash flow performance (180) of the asset pool.

Owner:TRADE METRICS CORP

Certificate of deposit portfolio system and method

InactiveUS7542933B2Superior credit qualityLow costFinanceMarketingIssuing bankRegistration authority

A certificate of deposit (“CD”) portfolio system and method to attract institutional investors through dealers to CD issuing small to medium sized community deposit taking institutions. The central entities of the system include a system operator and a system clearing house. The system operator contacts and signs up the institutions to become a part of the system. These institutions are community banks that are too small to individually attract institutional investors. It also contacts and signs up dealers and then unitizes FDIC insured CD's into single investment instrument portfolios which the dealers then market to their institutional investor clientele. The clearing house is in communication with the system operator, the institutions and the dealers to act as an agent facilitating transactions by issuing the CD's, handling funds, settling transactions, and acting as custodian / trustee for all transactions. The invention includes a system operator controlled internet website to provide access to information to for the use of CD issuing banks, the system clearing house, the system operator and the dealers. In effect the invention creates a meeting place for small banks to pool their FDIC insured CD's together into single investment instrument portfolios large enough to attract institutional investors at favorable interest rates because of the credit enhancement resulting from full FDIC insurance of the portfolio. This is achieved because the system and method prevent exceeding the $100,000.00 FDIC insurance limit per investor per bank.

Owner:INSTIONAL DEPOSITS

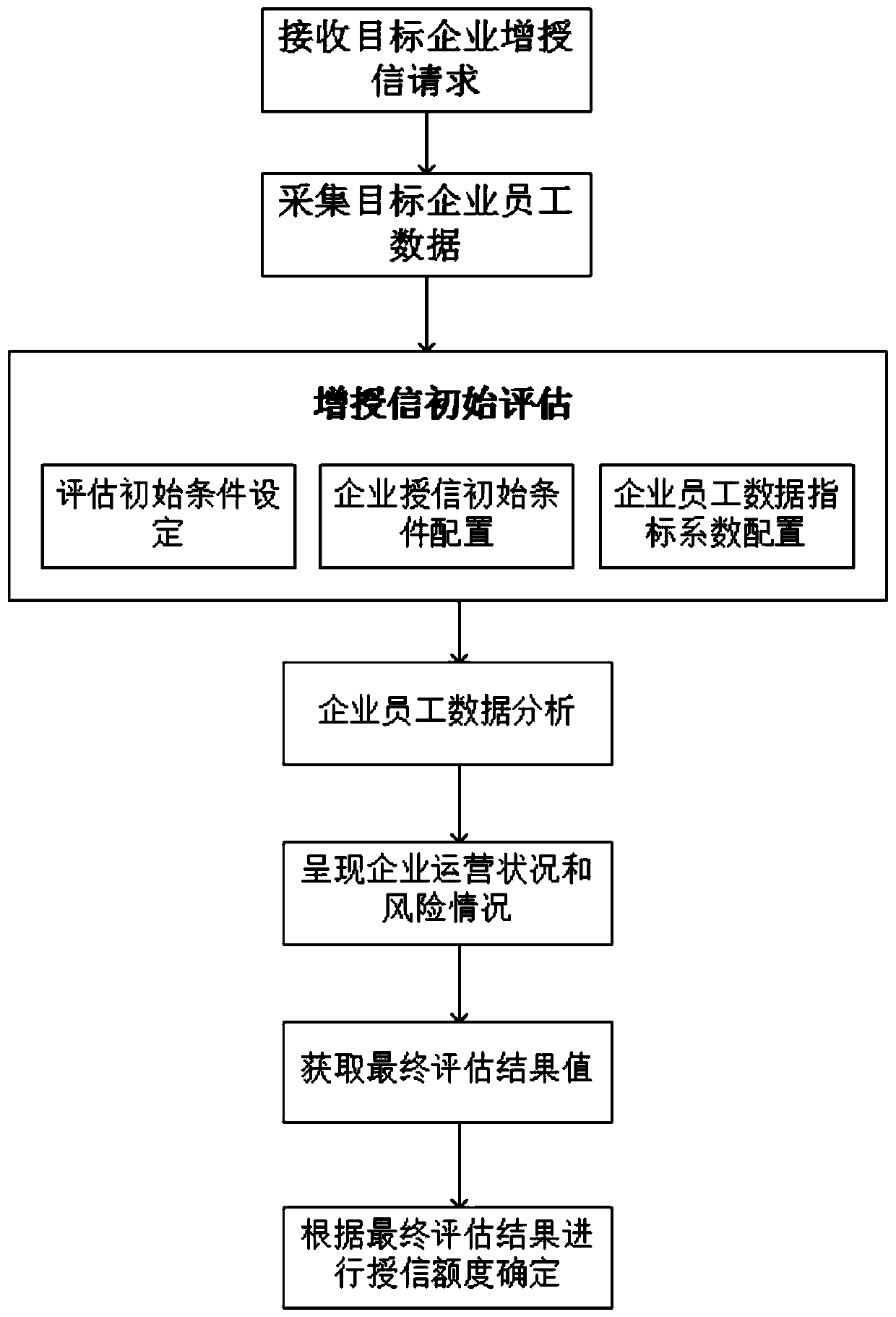

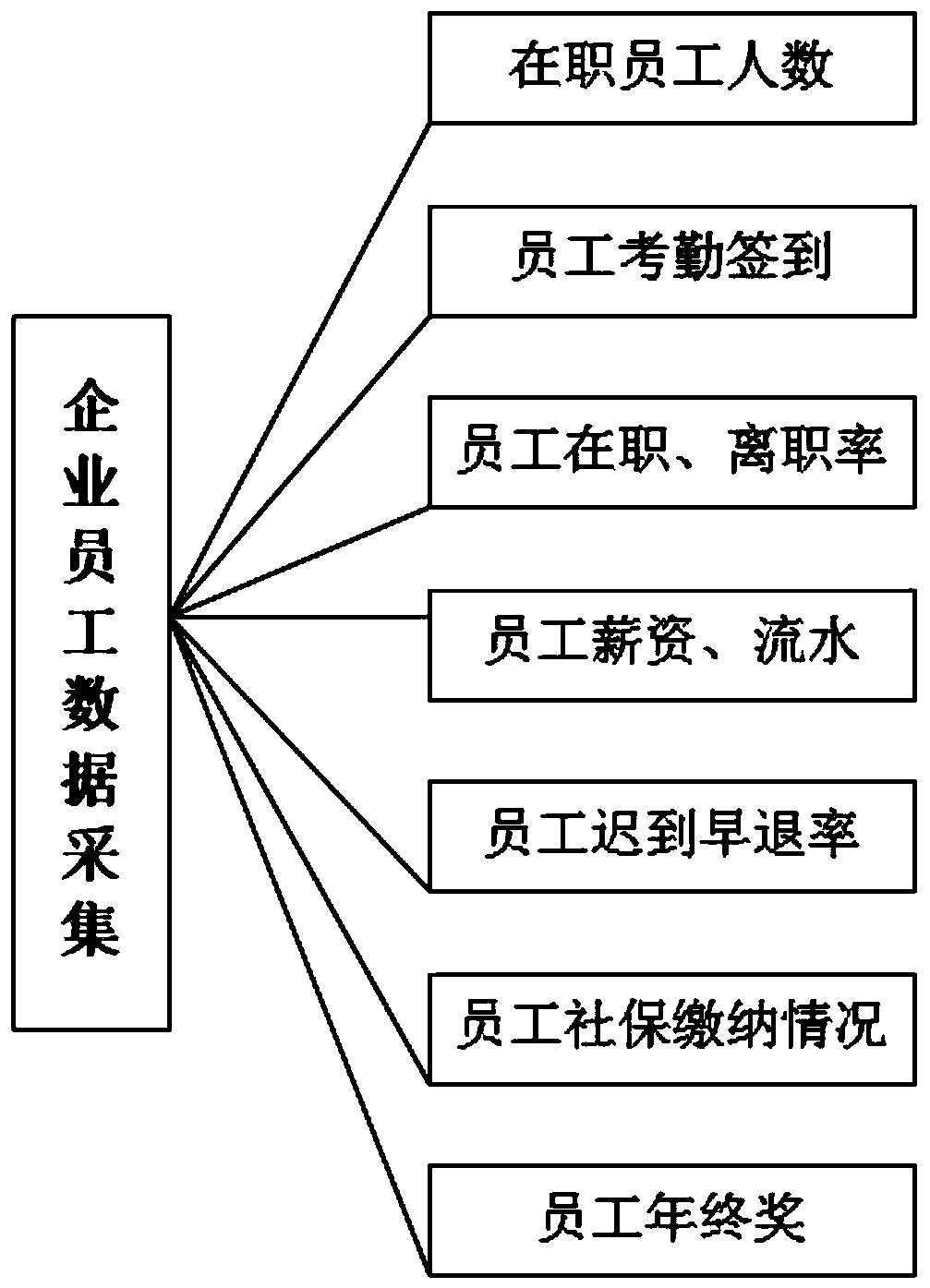

Method for determining enterprise credit increment based on enterprise employee data

The invention belongs to the field of enterprise credit extension service systems, and discloses a method for determining enterprise credit increment based on enterprise employee data, which solves the problems of inaccurate evaluation of enterprise collateral value and inconformity of enterprise credit increment and enterprise operation conditions, and comprises the following operation steps: receiving a credit increment request sent by a target enterprise, understanding target enterprise information, and collecting target enterprise employee data; carrying out credit augmentation evaluation,wherein the credit augmentation evaluation comprises evaluation initial condition setting, enterprise credit augmentation initial condition configuration and enterprise employee data index coefficient configuration; analyzing enterprise employee data; obtaining a final result value of the target enterprise credit enhancement assessment, and presenting the enterprise operation condition and the risk condition; and determining the credit amount range of the target enterprise according to the credit evaluation result value of the target enterprise. The real operation condition of the enterprisecan be obtained by analyzing the employee data condition of the target enterprise, and the efficiency and accuracy of enterprise credit evaluation are effectively improved.

Owner:深圳市宝润兴业互联网信息服务有限公司

A service recommendation method for service supply chain network

ActiveCN104166702BImprove accuracyData processing applicationsSpecial data processing applicationsRecommendation serviceService user

The invention discloses a service recommendation method oriented to a service supply chain network. Firstly, a transfer matrix is constructed based on the link relationship between all nodes in the service supply chain network, and the reputation values of all nodes are calculated according to the transfer matrix; and then two-two nodes are calculated. The similarity between reputation enhancements is used to construct the neighbors of all nodes; finally, for users who need recommended services, predict the service quality evaluation value of the user for the required service according to the neighbors of the corresponding nodes, and recommend high service quality evaluation values to them services. The service recommendation method of the present invention can successfully predict the user's service quality evaluation value for the required service when the historical data is insufficient or some nodes do not have historical data, and overcomes the data sparsity and cold start existing in the existing collaborative filtering technology problem, improving the accuracy of service recommendation.

Owner:ZHEJIANG UNIV OF FINANCE & ECONOMICS

Programmable Financial Instruments

A method and system is disclosed for creating and using programmable financial instruments. The method and system addresses the problems caused by limiting the scope of financial instruments to inert objects, whether considered as abstract data or in a physical embodiment such as a paper certificate. Applications of the method and system include trading, portfolio management, collateralization, securitization, securities lending, securities borrowing, and credit enhancement.

Owner:GROZ MARC MICHAEL

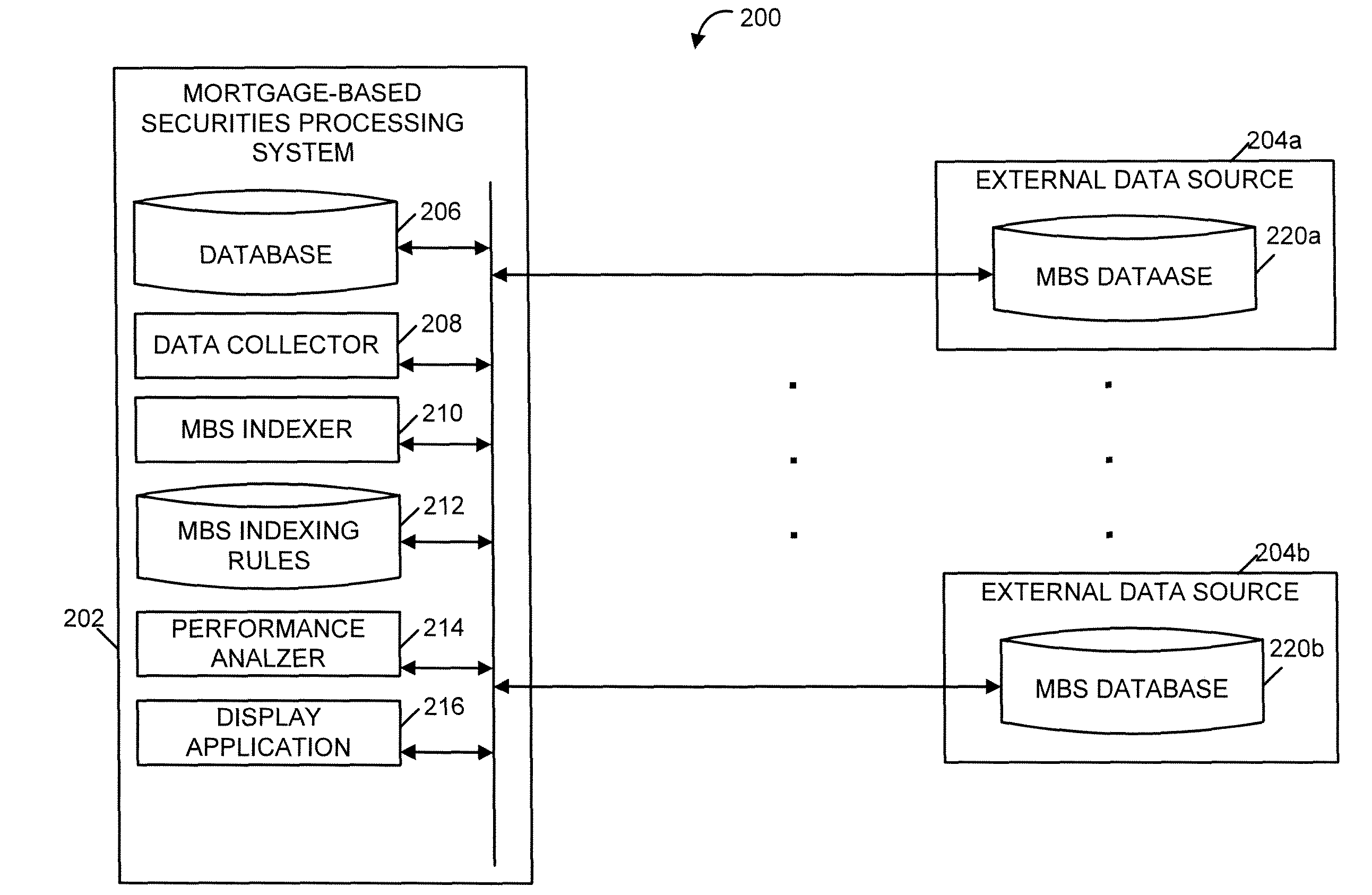

Method and System for Electronically Processing Mortgage-Backed Securities

A mortgage-backed securities (MBS) processing system including a processor, a database and a computer-readable memory. The database is configured to store data pertaining to multiple mortgage-backed securities, each mortgage-backed security associated with at least one loan. The computer-readable memory includes computer-readable instructions. When the computer-readable instructions are executed on the processor to associate the multiple mortgage-backed securities stored in the database with a set of different MBS indices based on MBS indexing rules. The MBS indexing rules map a given mortgage-backed security to a given MBS index based at least in part on the credit enhancement type associated with the given mortgage-backed security.

Owner:KCG IP HLDG

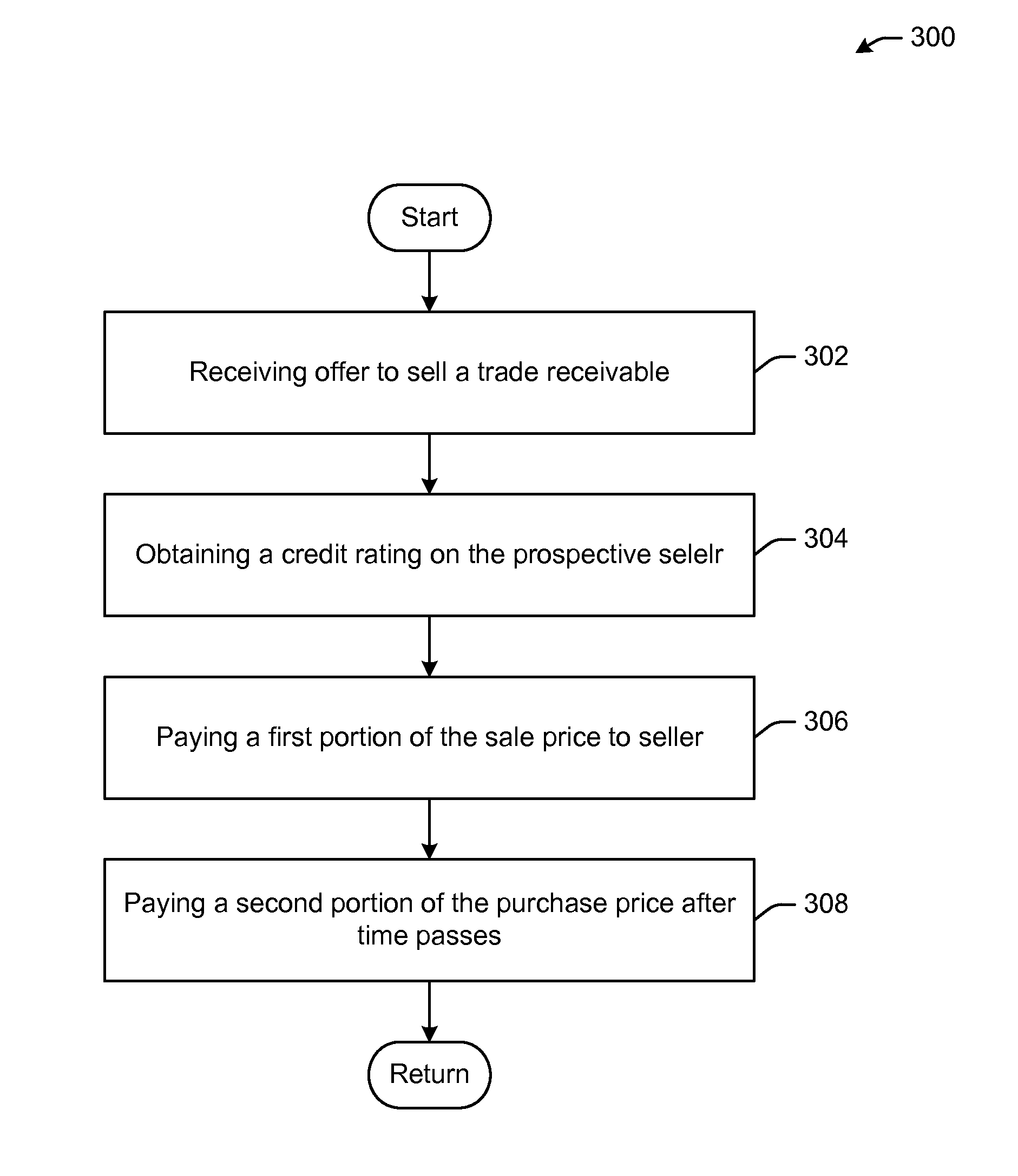

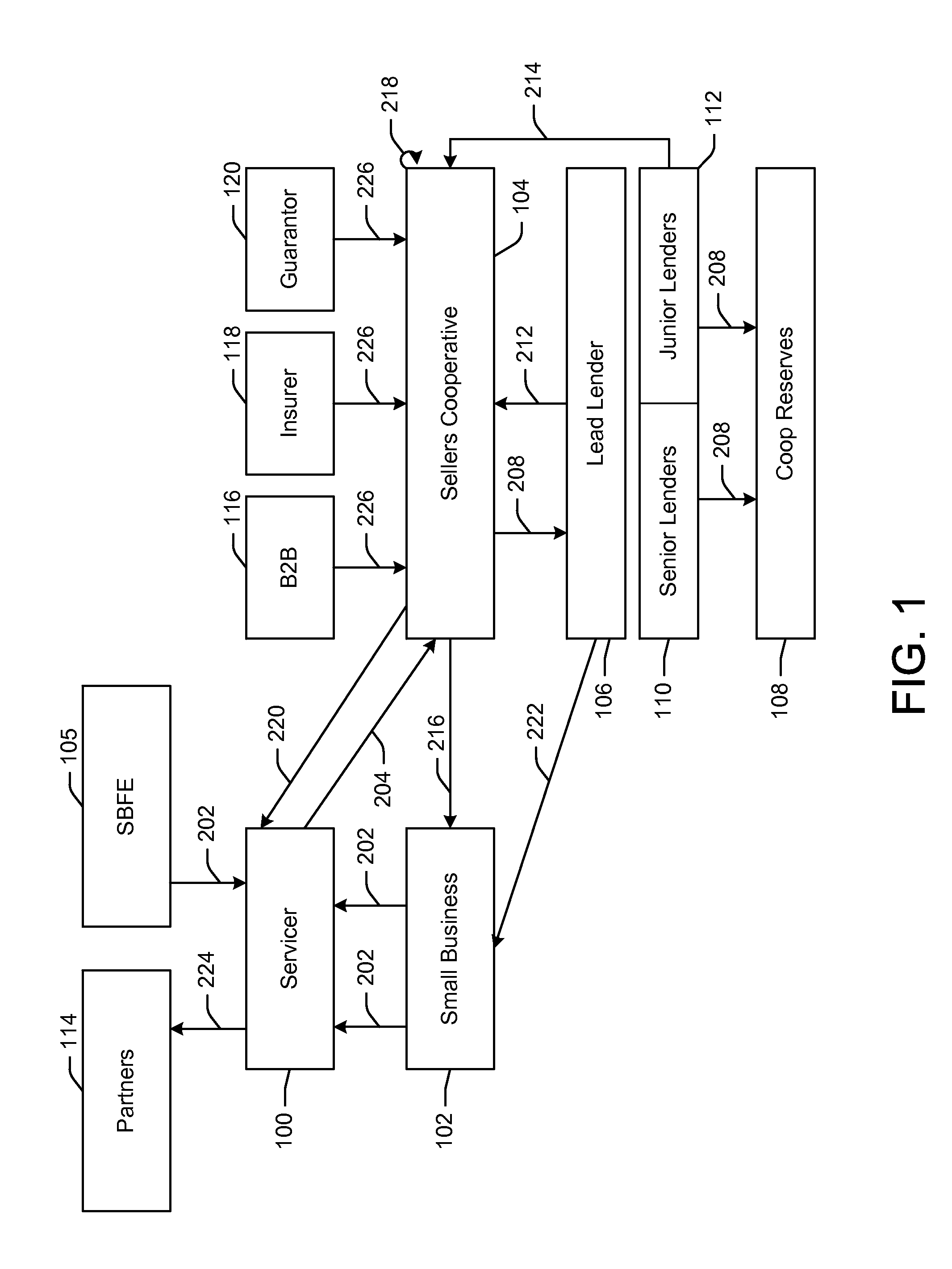

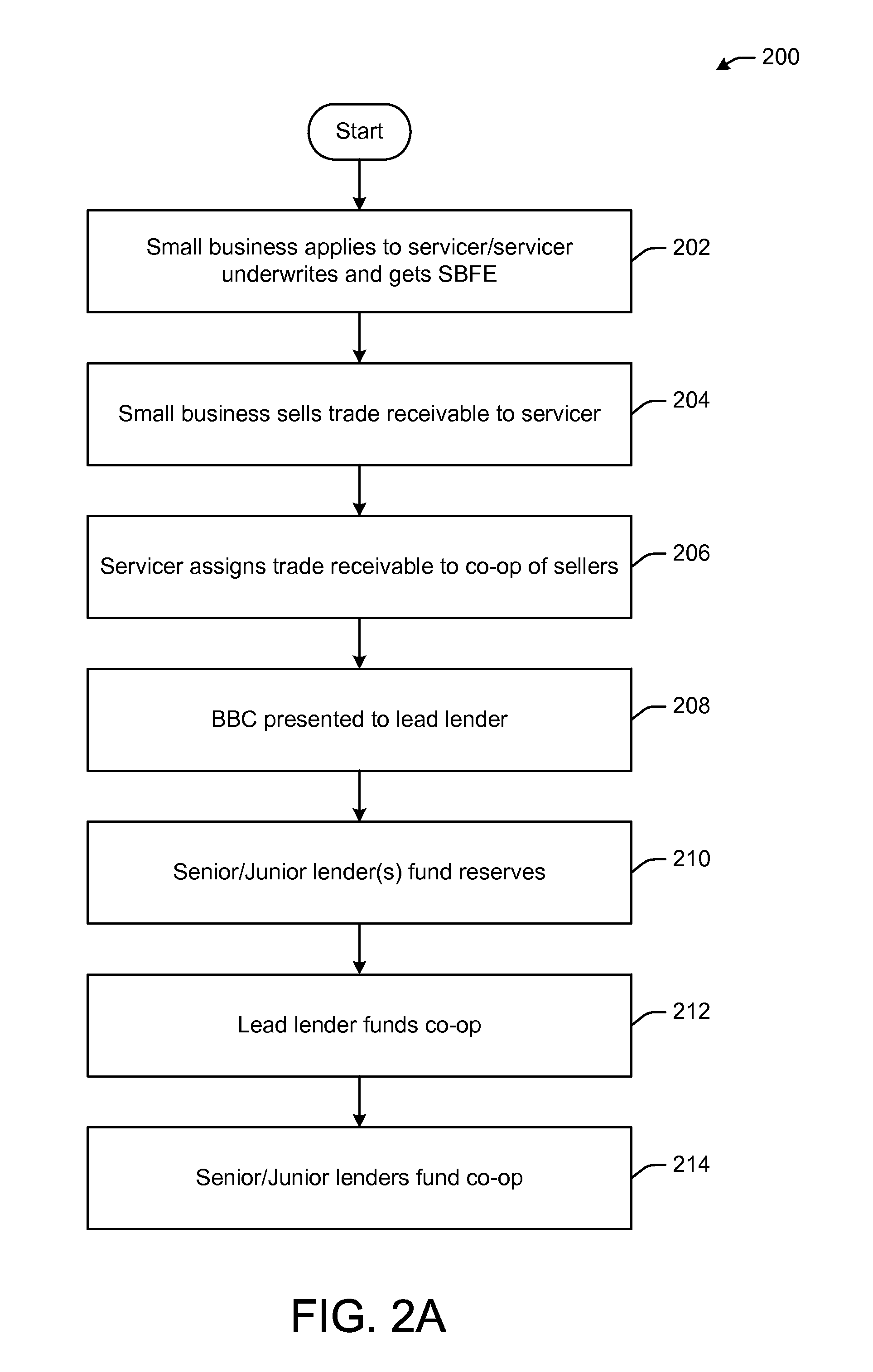

Systems and Methods for Credit Enhancement for Trade Credit Transactions

Embodiments of the disclosure can include systems and methods for credit enhancement for trade credit transactions. In one embodiment, a method of reducing risk in trade credit transactions can be provided. The method can include receiving an offer to sell a trade receivable from a business; obtaining a credit rating for the business; instructing a sellers cooperative to pay a first portion of a purchase price to the seller, the sellers cooperative comprising small businesses that purchase trade receivables; and instructing a lender to release a second portion of the purchase price held in escrow to the seller after a period of time has passed.

Owner:NOWACCOUNT NETWORK

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com