Patents

Literature

42 results about "Settlement date" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Settlement Date is a securities industry term describing the date on which a trade (bonds, equities, foreign exchange, commodities, etc.) settles. That is, the actual day on which transfer of cash or assets is completed and is usually a few days after the trade was done. The number of days between trade date and settlement date depends on the security and the convention in the market it was traded. For example when settling a share transaction on the London Stock Exchange this is set at trade date + 2 business days.

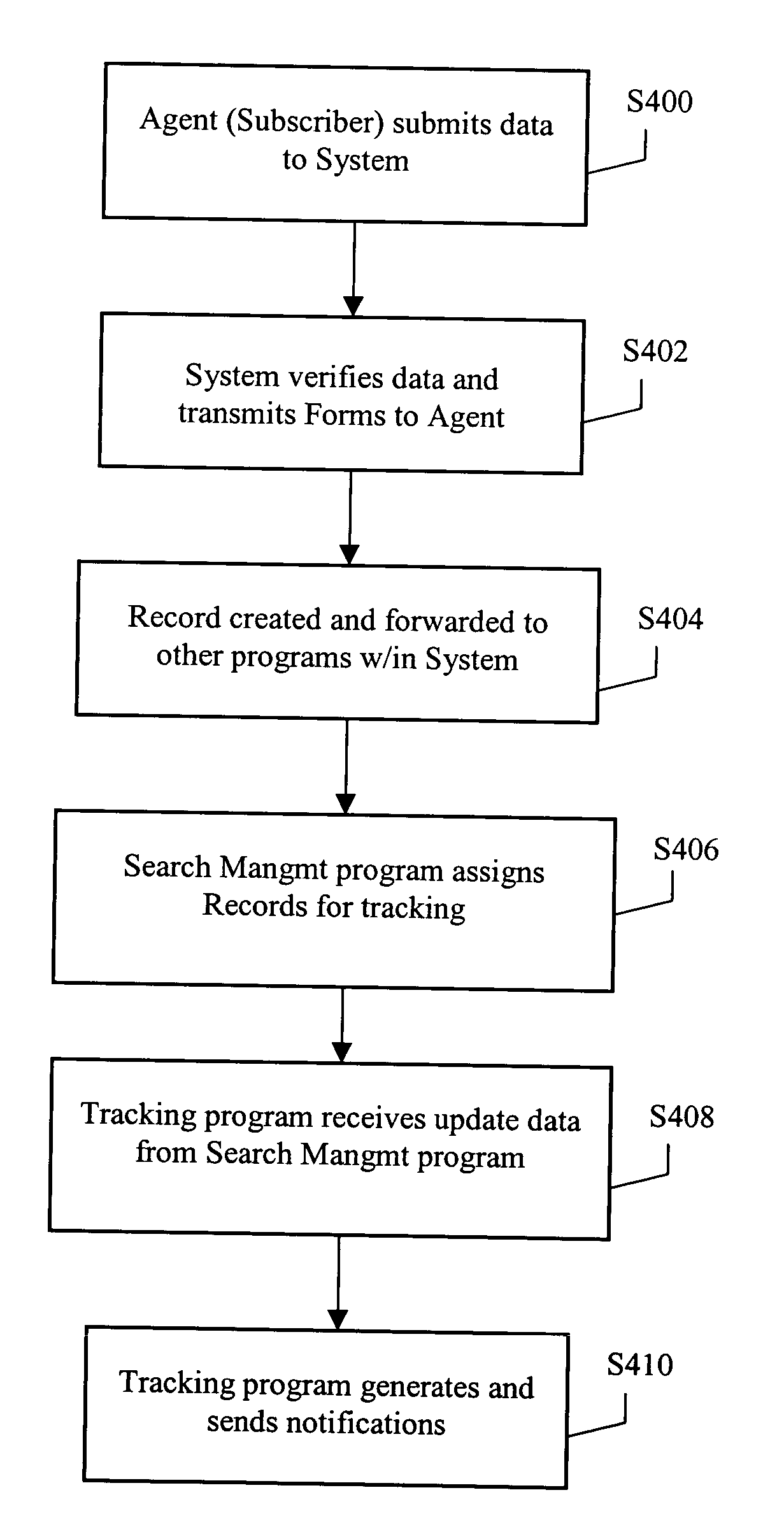

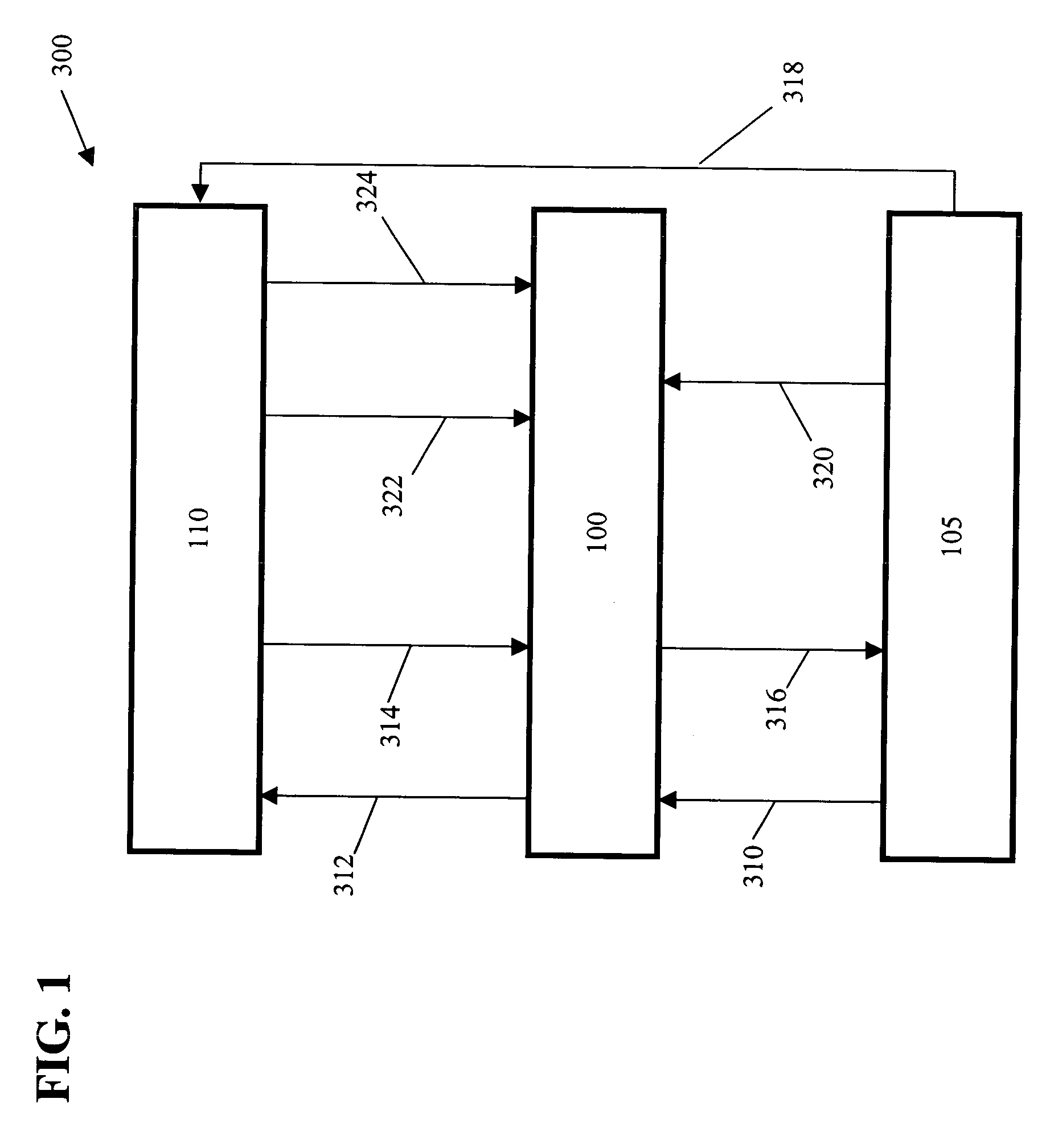

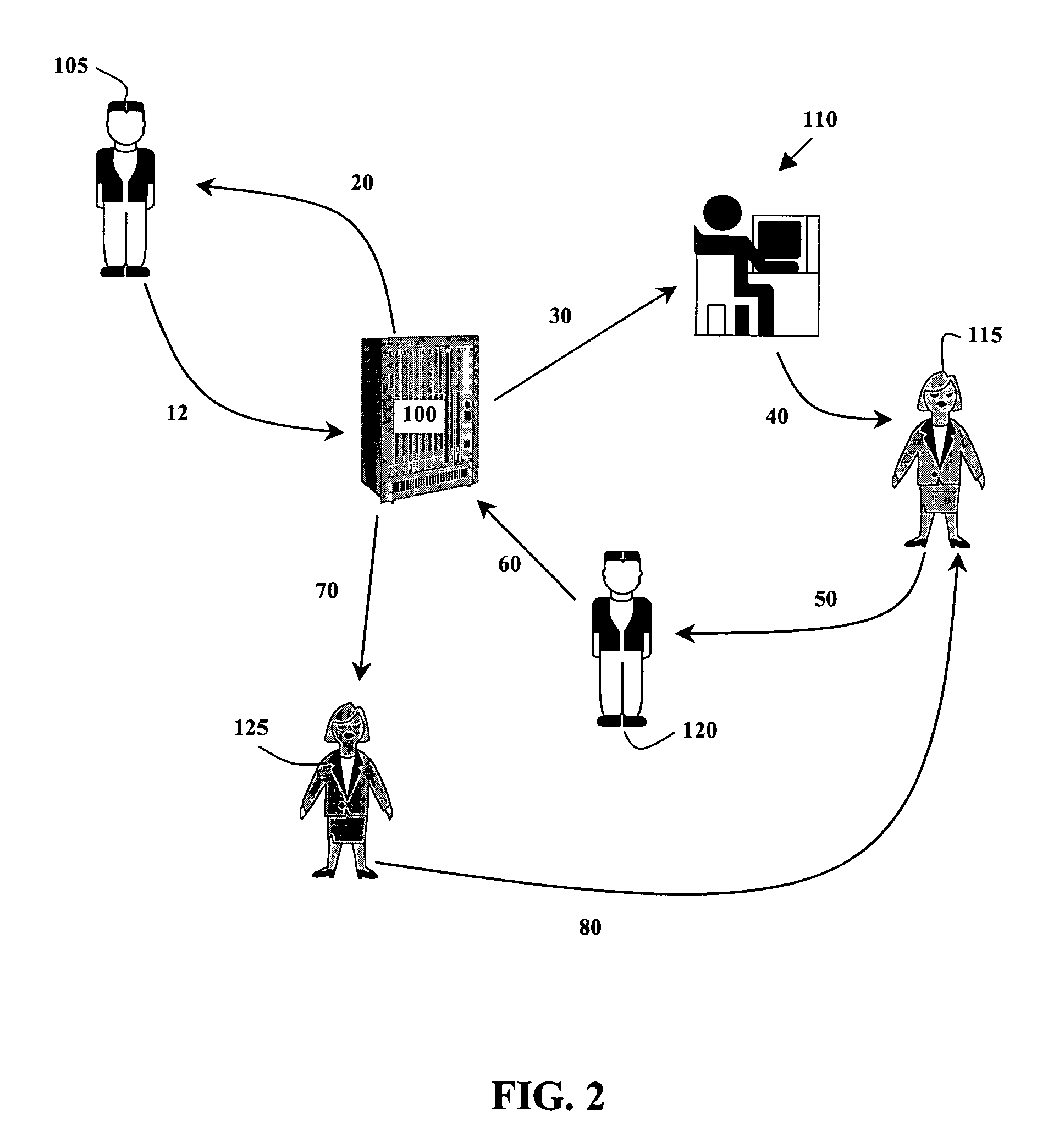

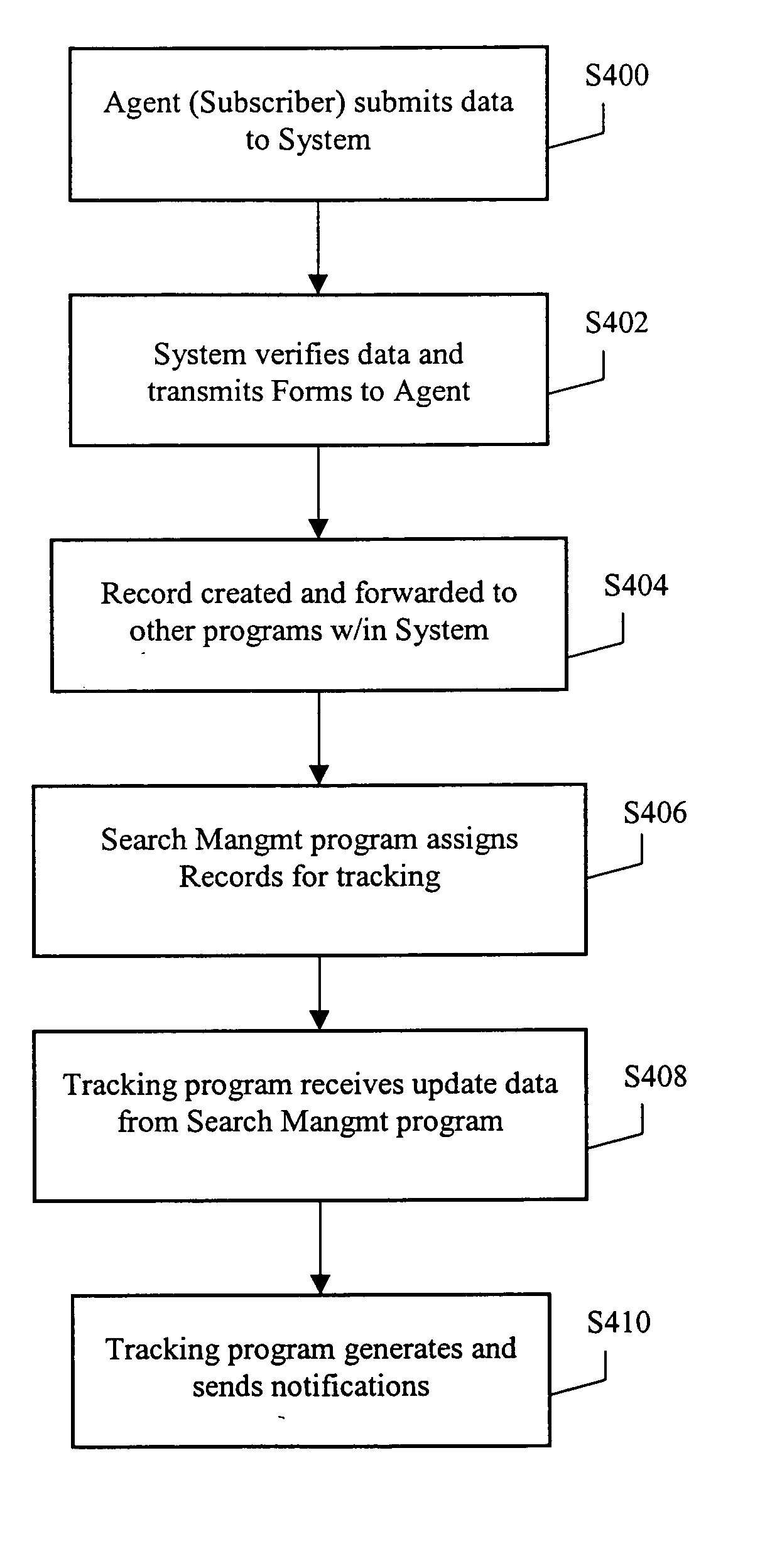

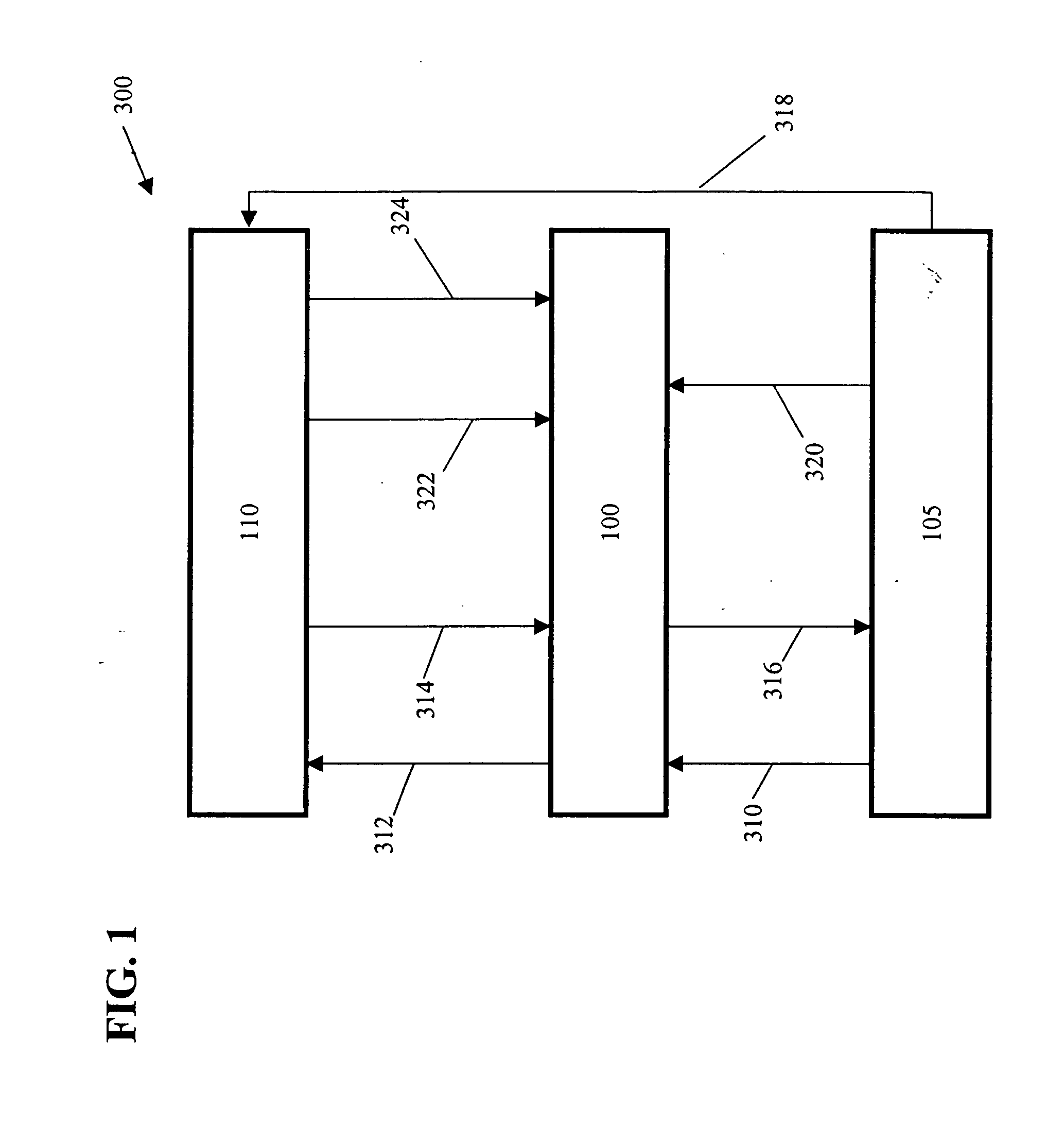

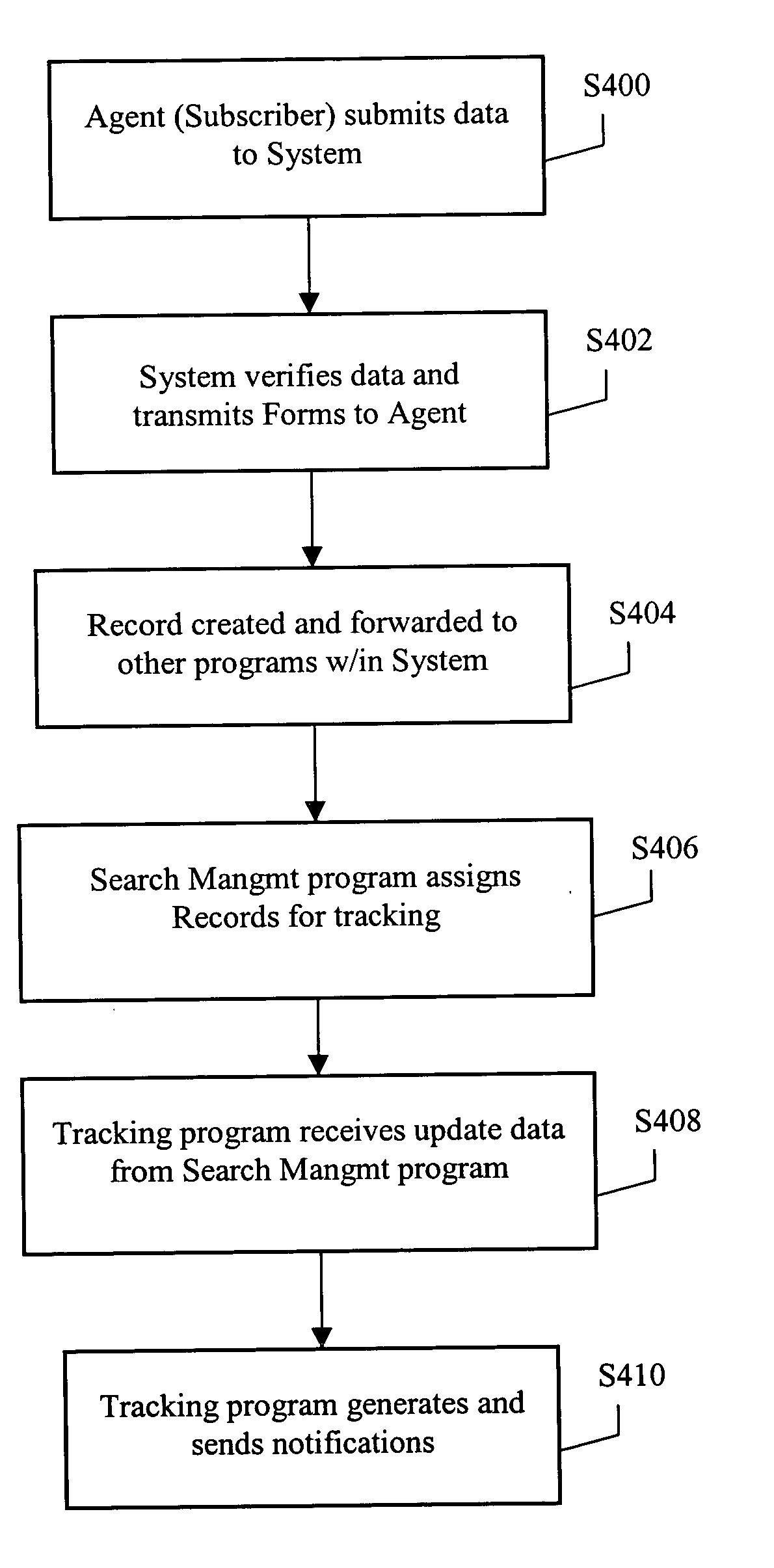

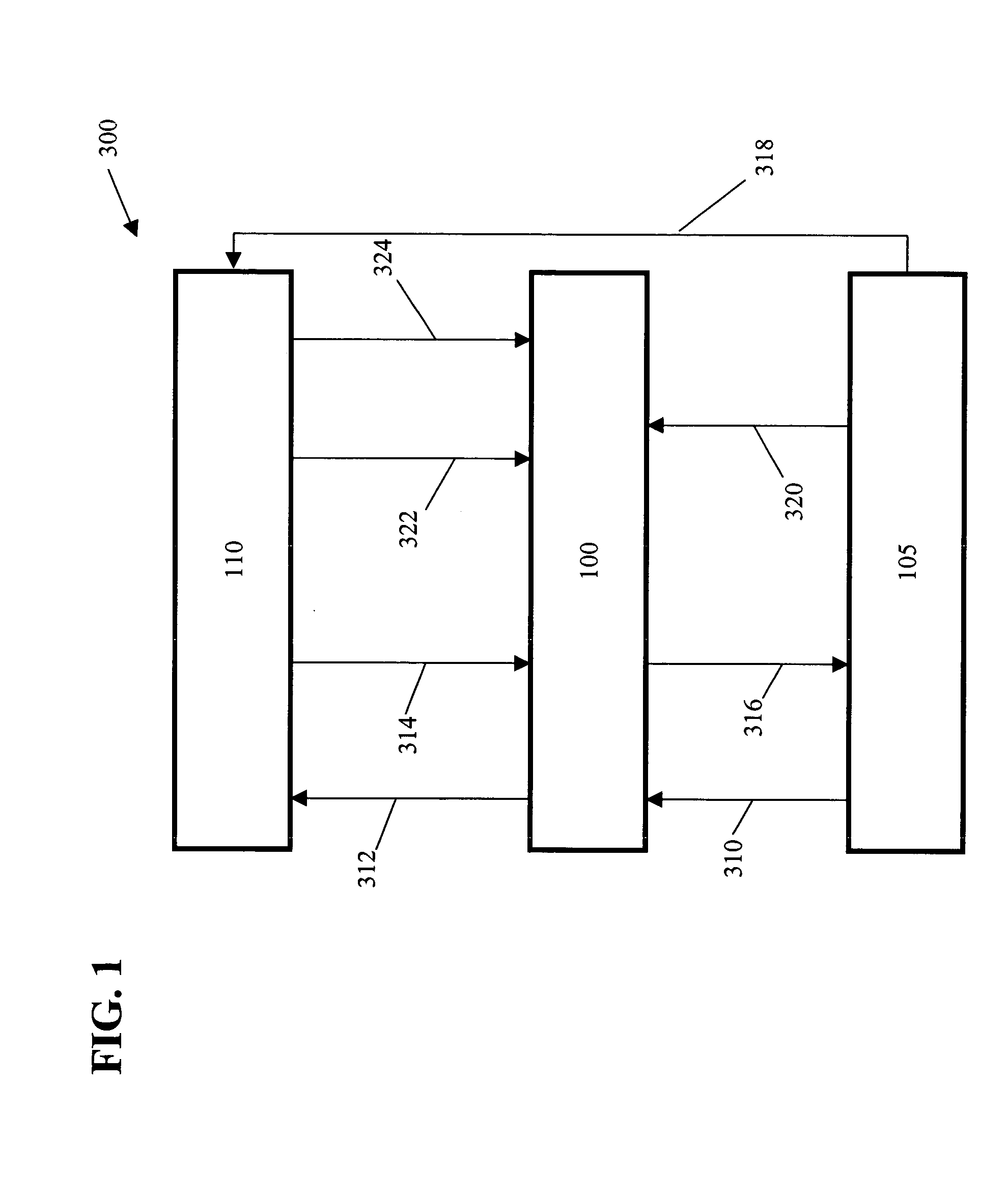

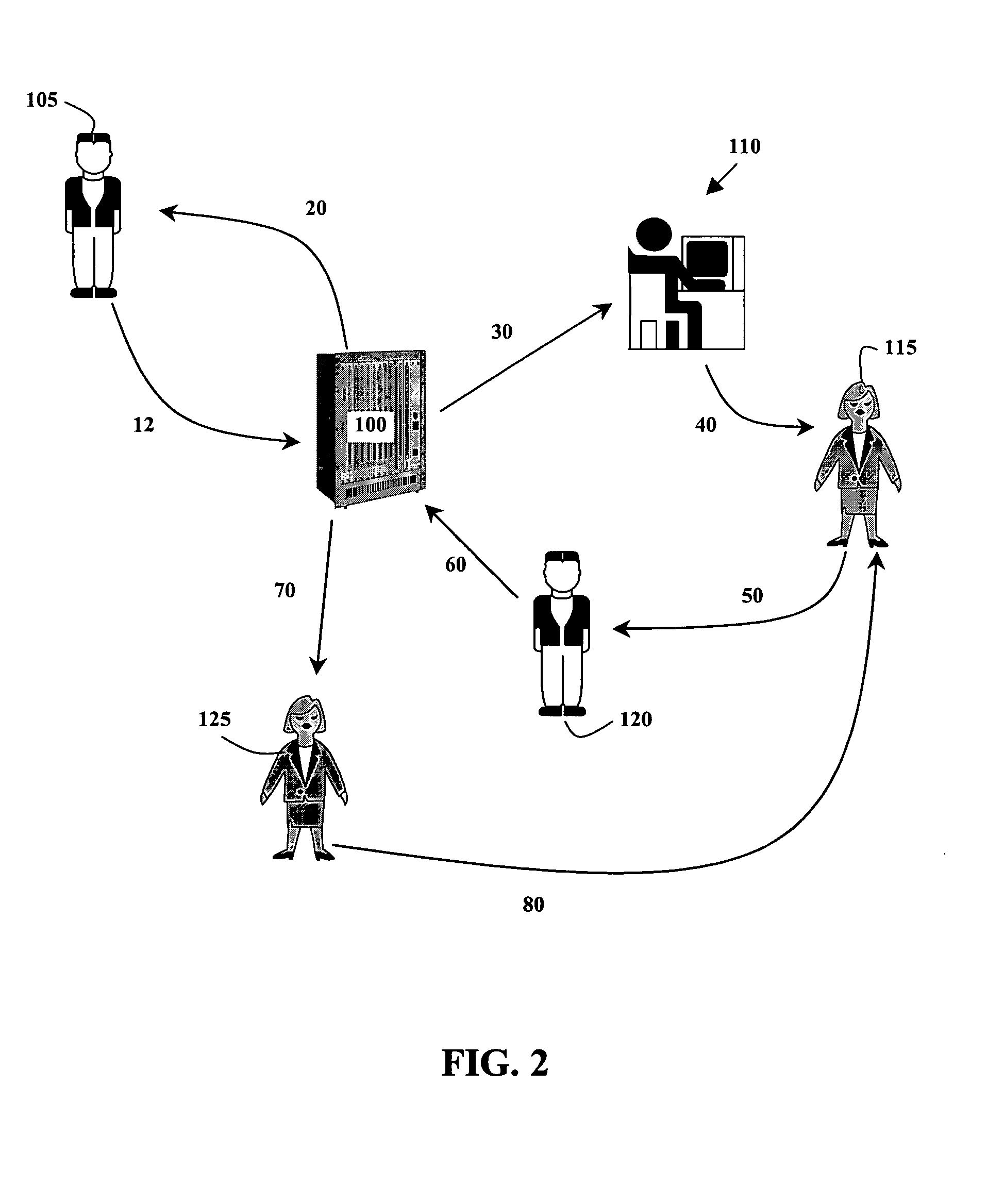

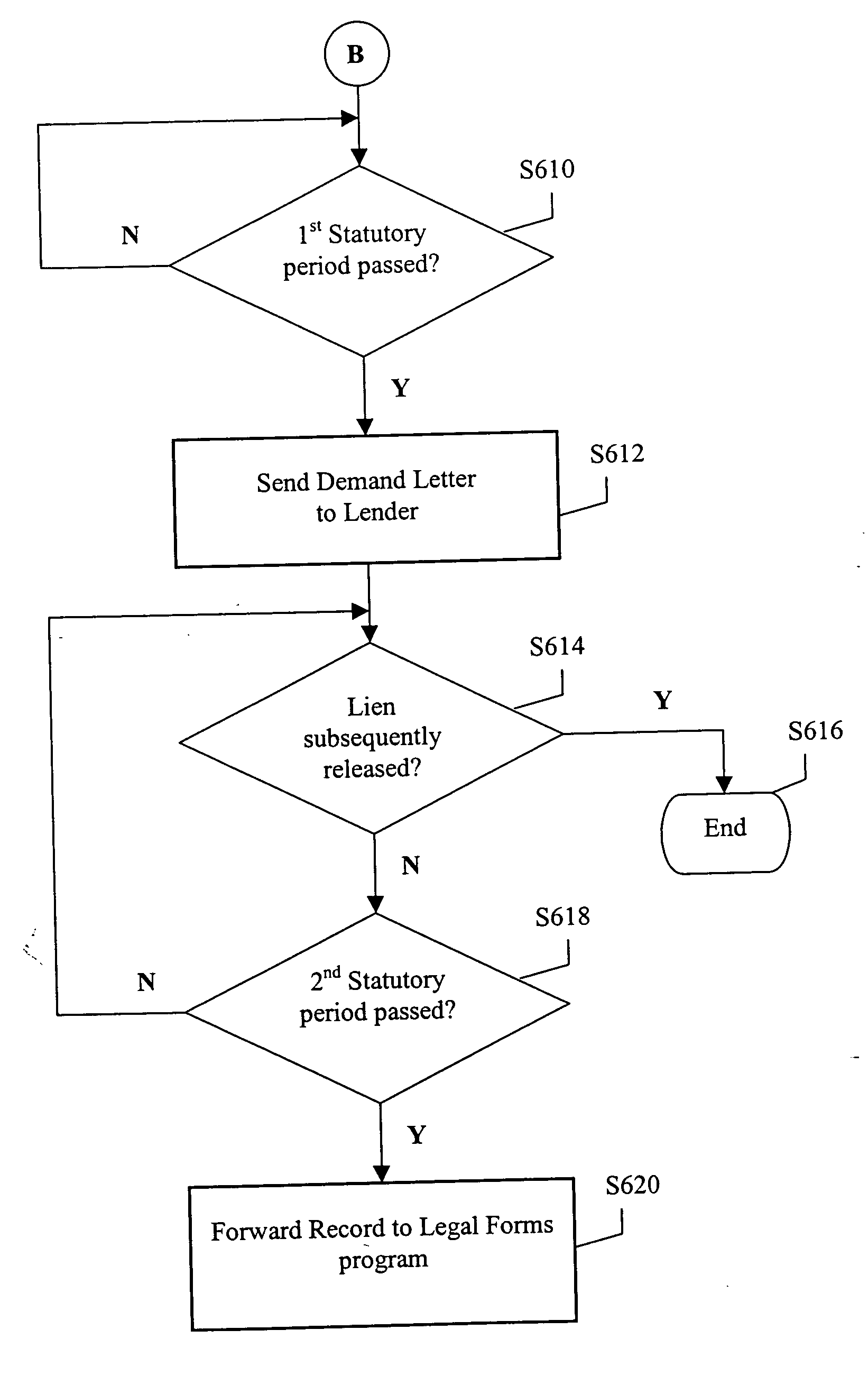

System and method for automated release tracking

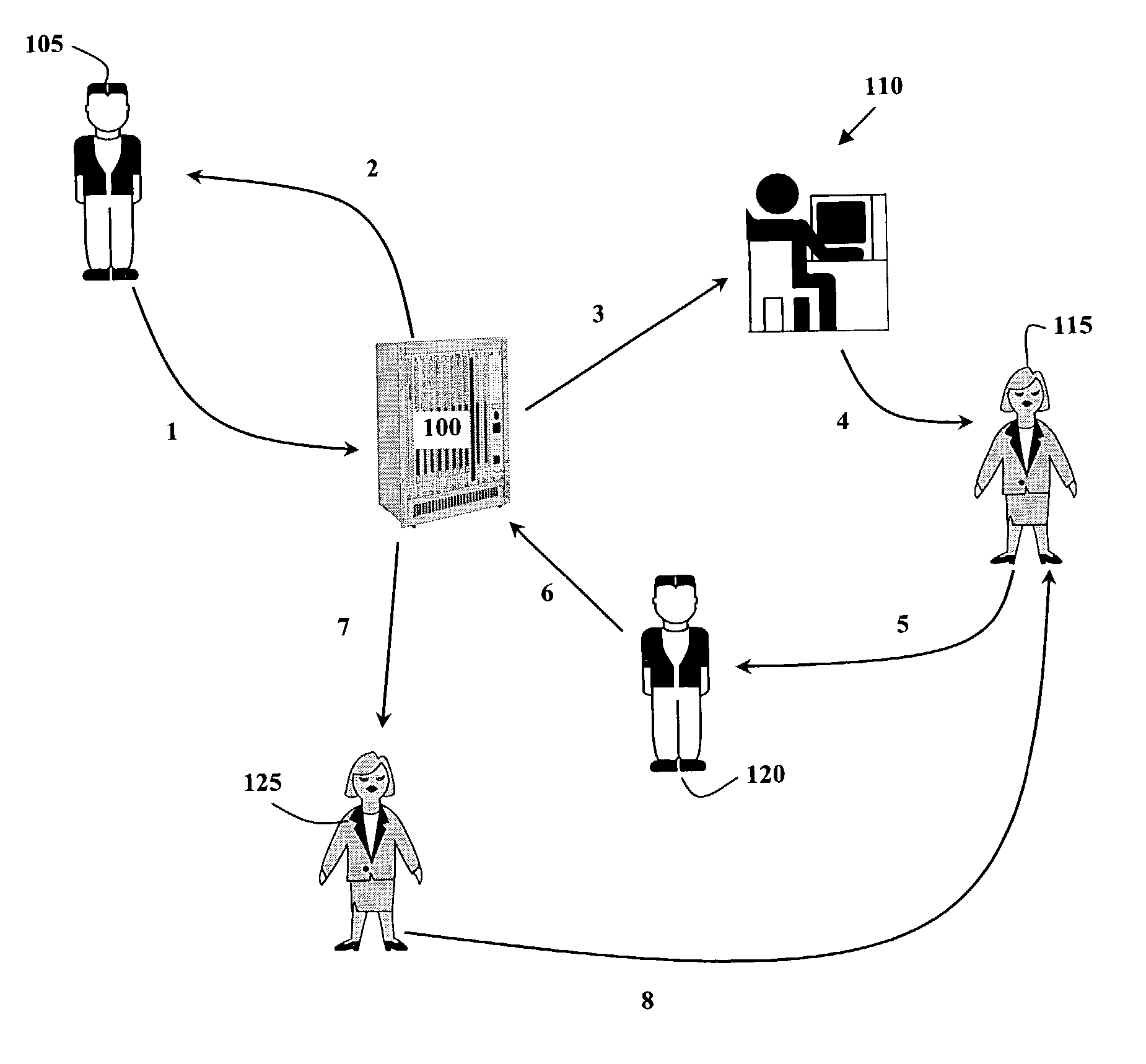

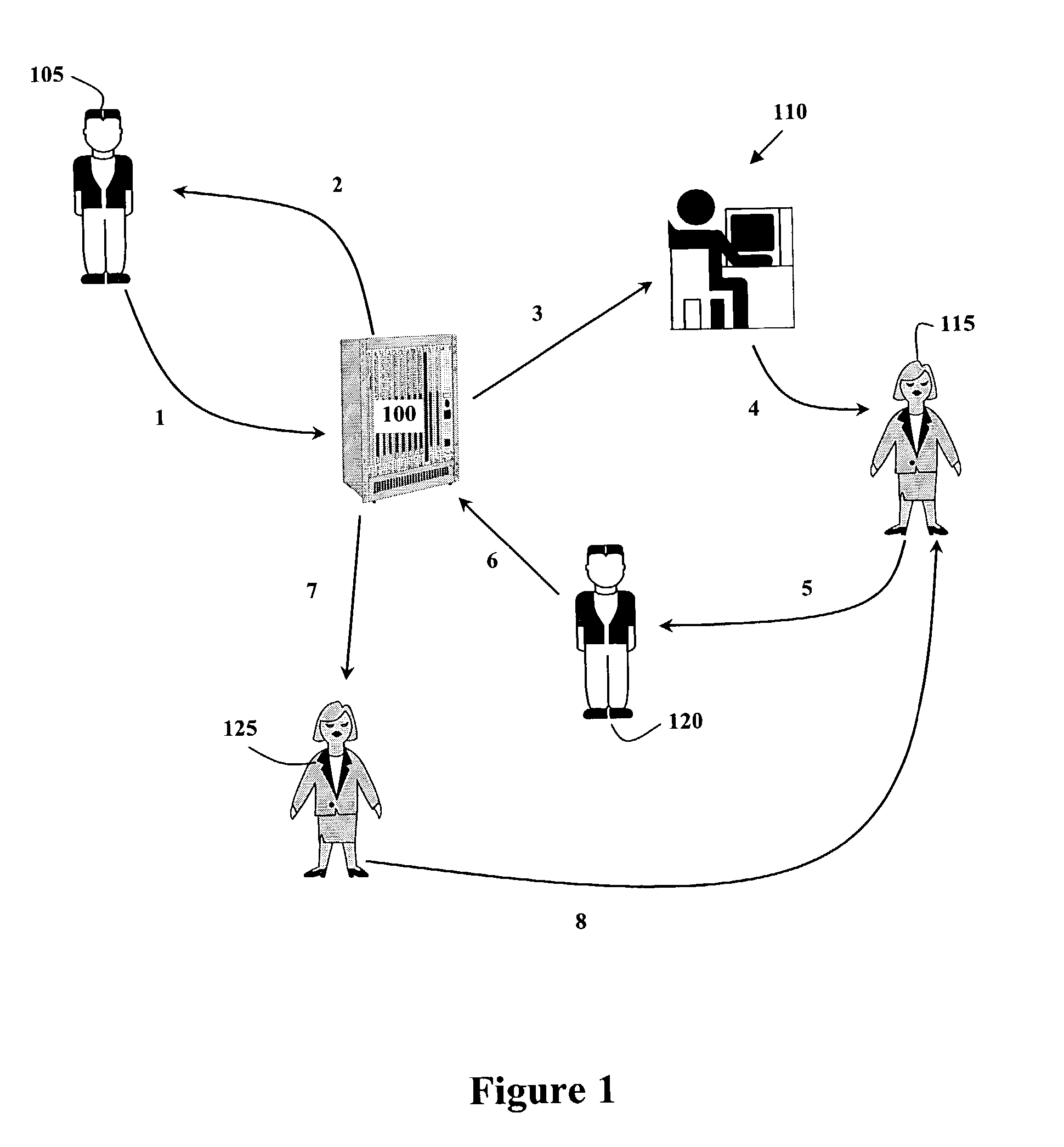

A real estate transaction and release tracking system ensures deeds of trust, liens and other encumbrances are released in a timely manner after a specified (or statutory) period of time following settlement of a real estate transaction. Based on information provided by an agent, such as an escrow agent or a settlement agent, the system creates a unique electronic record for each real estate transaction entered by the agent. The system tracks lien status information, either automatically from other computers or via manual input from searchers, and uses this status information to track each real estate transaction. The system monitors the records and indicates when a lien holder has failed to release their lien after a statutory time period that begins after the passing of the settlement date. When the statutory time period has passed, the system can generate a number of forms, including a demand letter as controlled optionally by the system or the user. The demand letter can be sent to the lien holder demanding them to release the lien. If the lien is not thereafter released, further legal documents can be generated and sent to a law firm or enforcement agent for legal action to be taken against the delinquent lien holder.

Owner:REQUIRE HLDG LLC

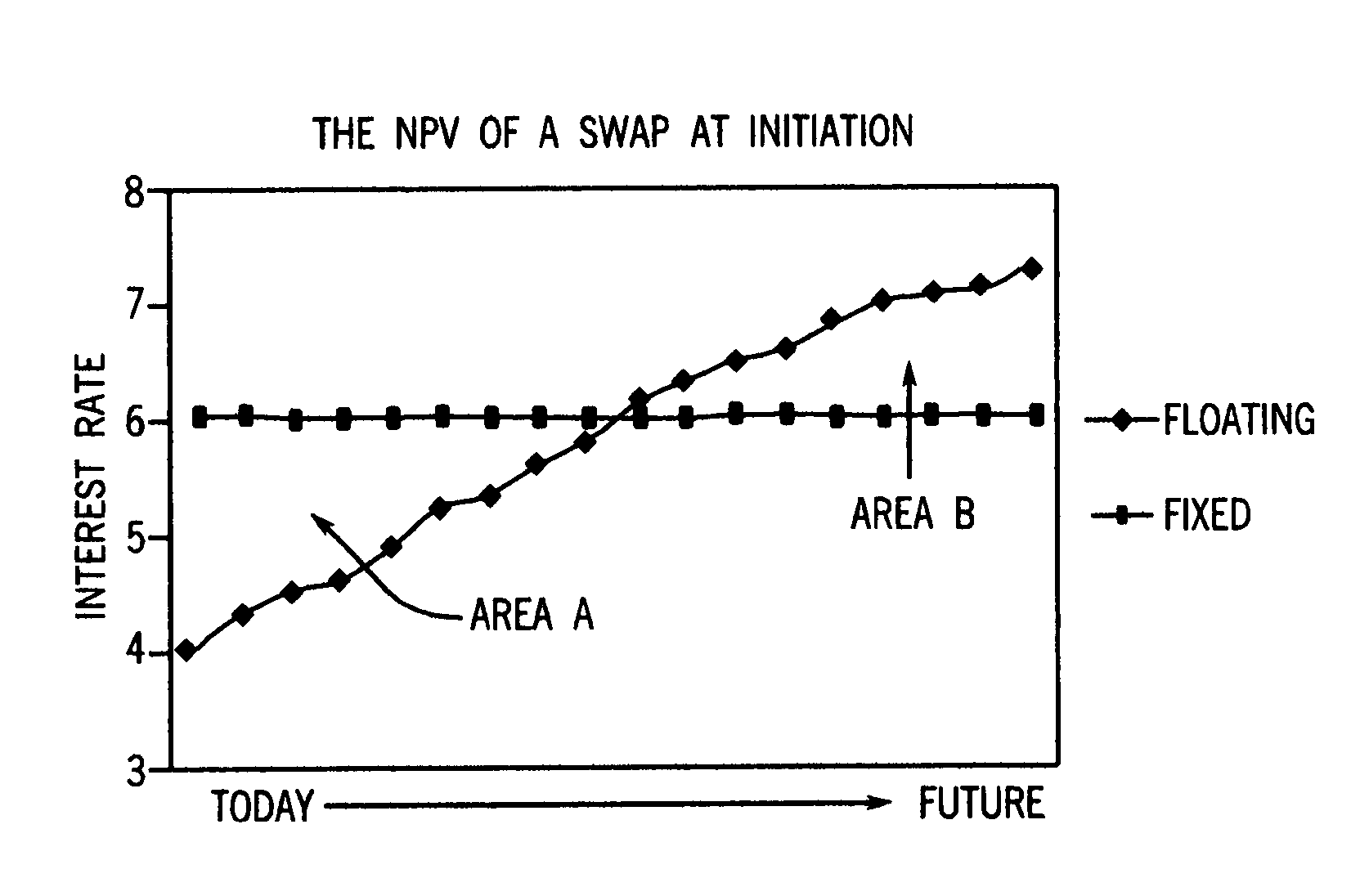

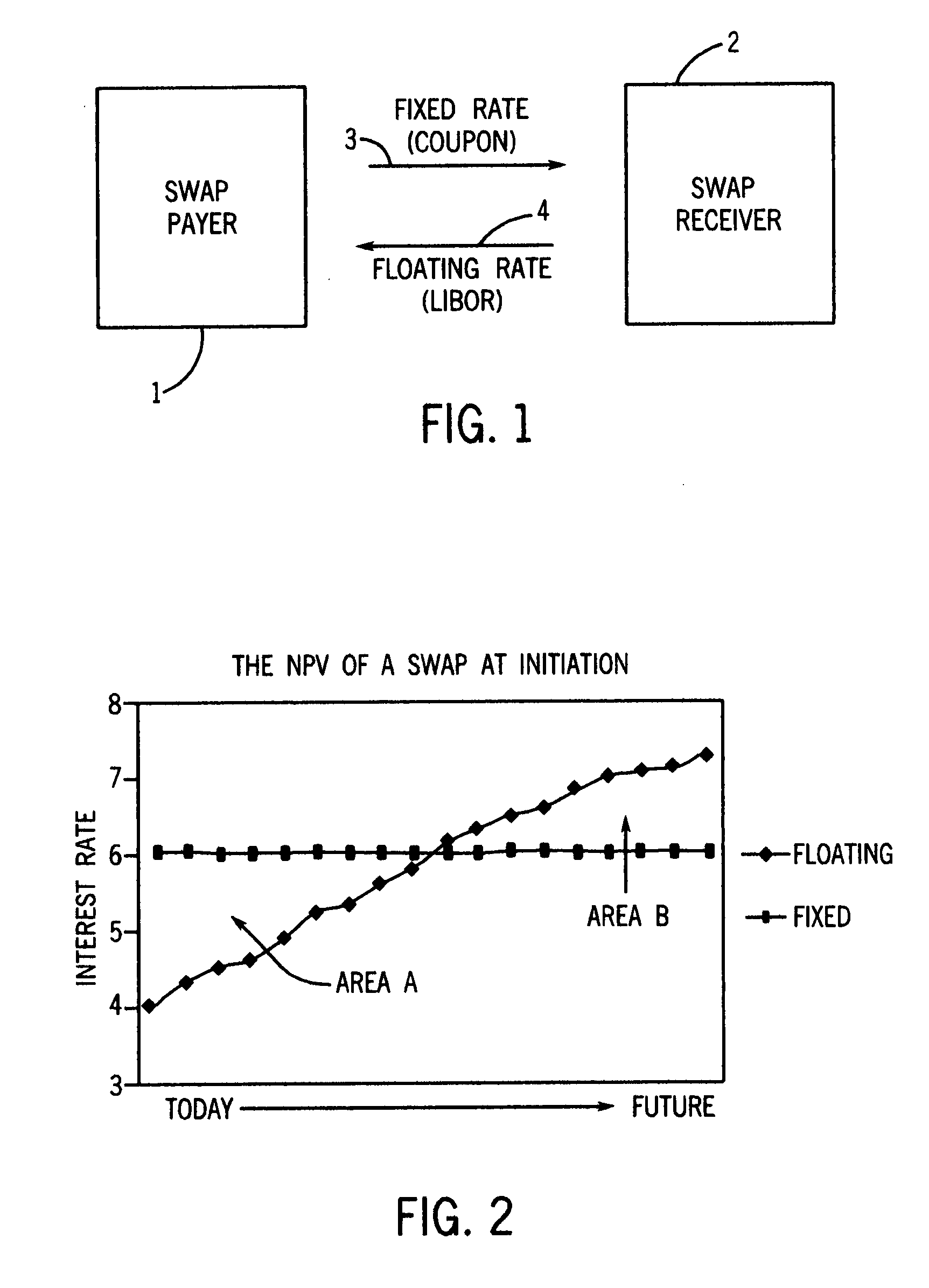

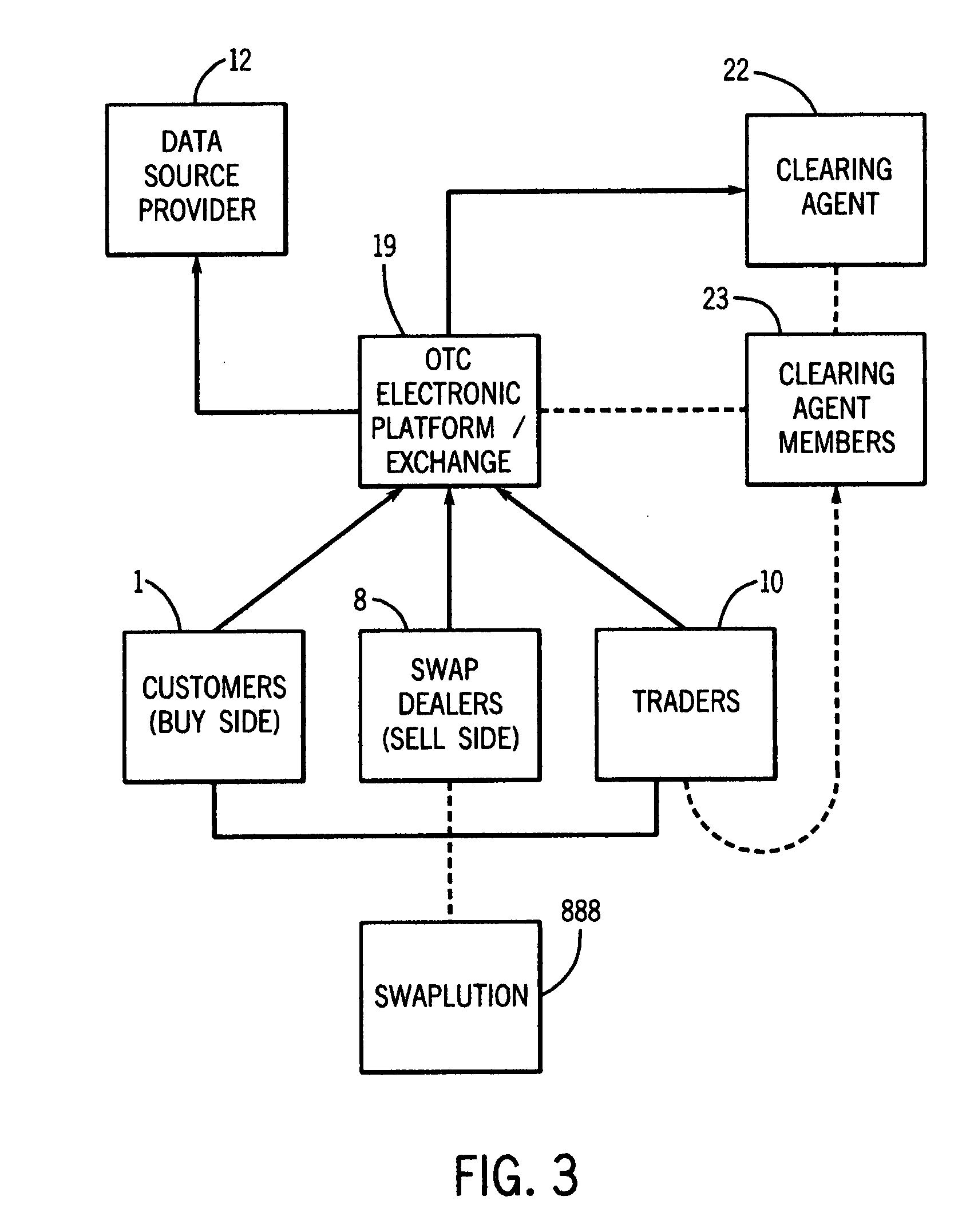

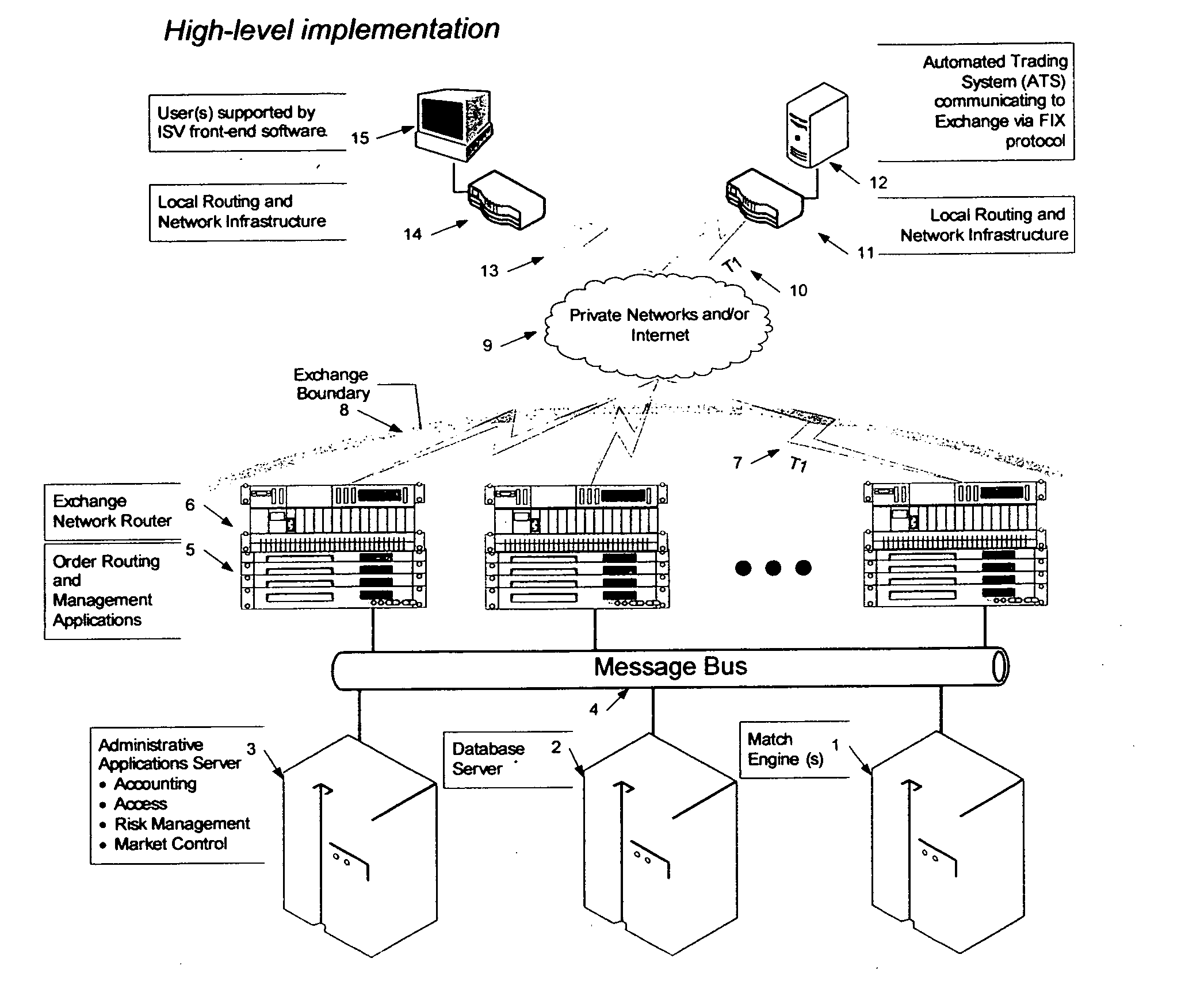

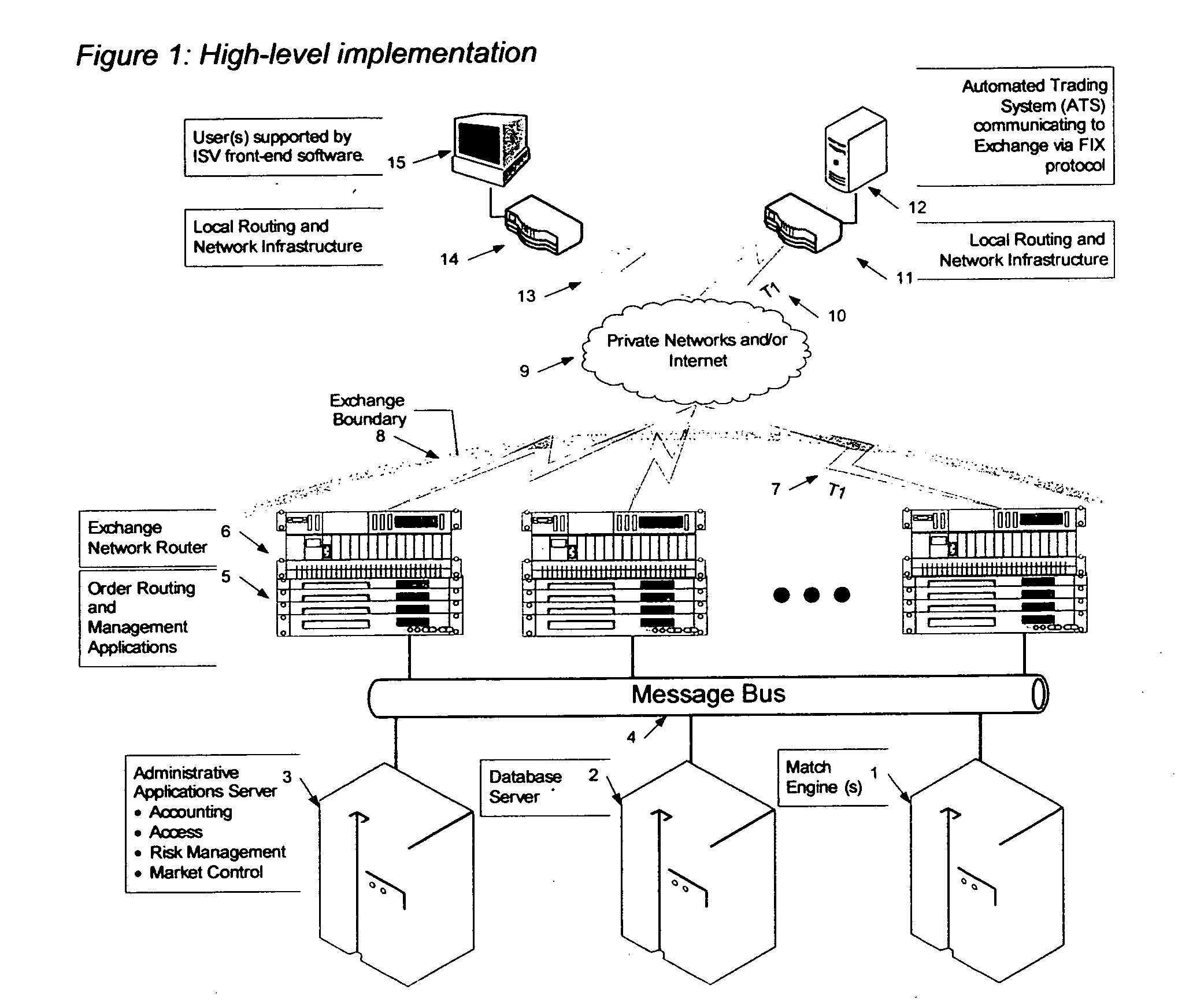

Method, system, and computer program for an electronically traded synthetic exchange traded coupon

InactiveUS20070288351A1Easy to trackReduce management costsFinanceInterest rate swapComputer science

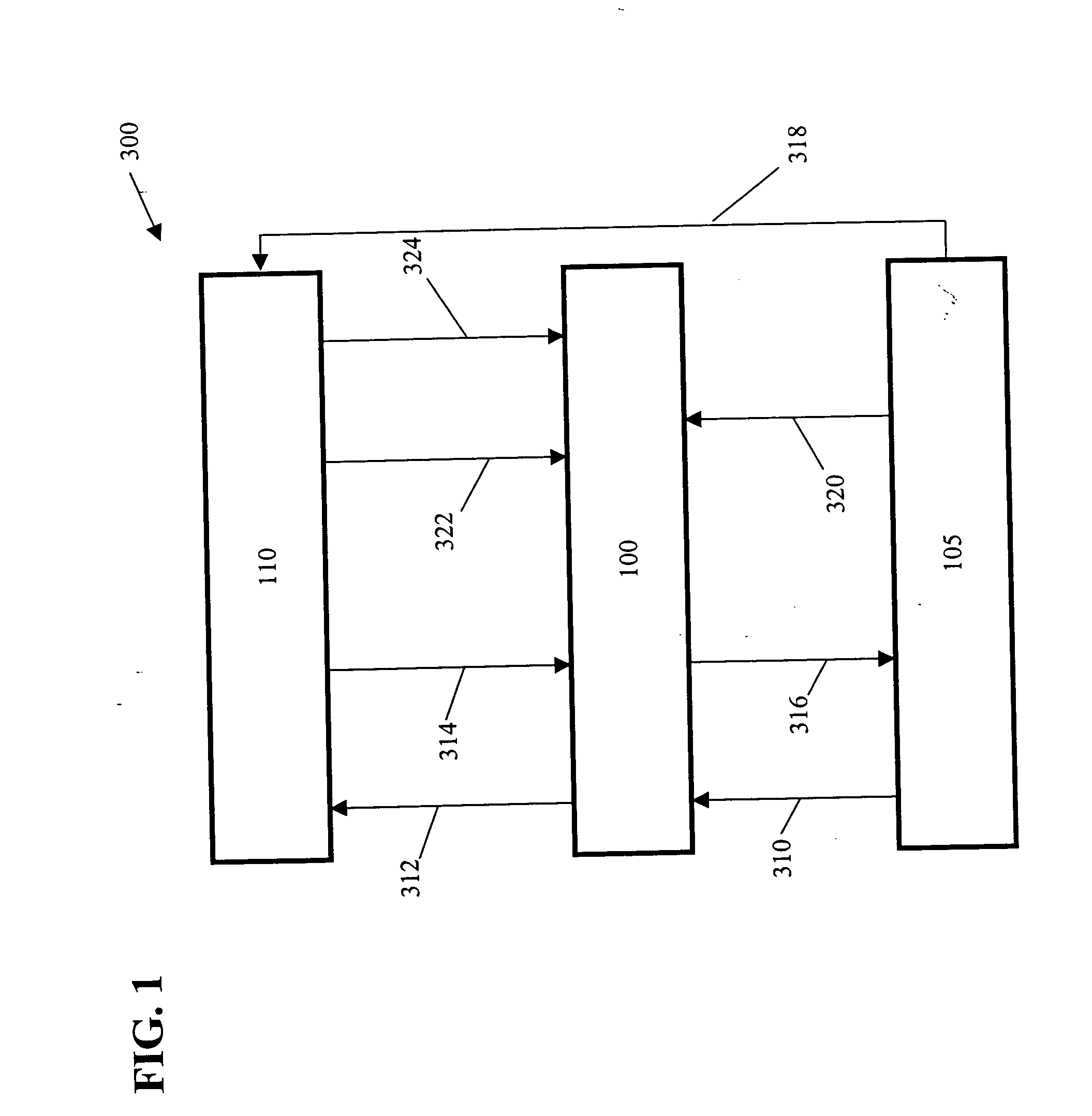

In accordance with the principles of the present invention, a novel method, system, process, and computer program is provided that synthetically replicates a plain vanilla IR Swap through a future as well as to create a more fungible interest rate swap in the spot market. The forward start interest rate swaps of the present invention consist of a consecutive series of futures that value a forward start interest rate swap to start on a settlement date. The futures replicate the floating-rate payment terms for the interest rate swap that is being synthetically replicated. The spot interest rate swap is a standardized interest rate swap that is fungible.

Owner:HUNTLEY RUSSELL GUY

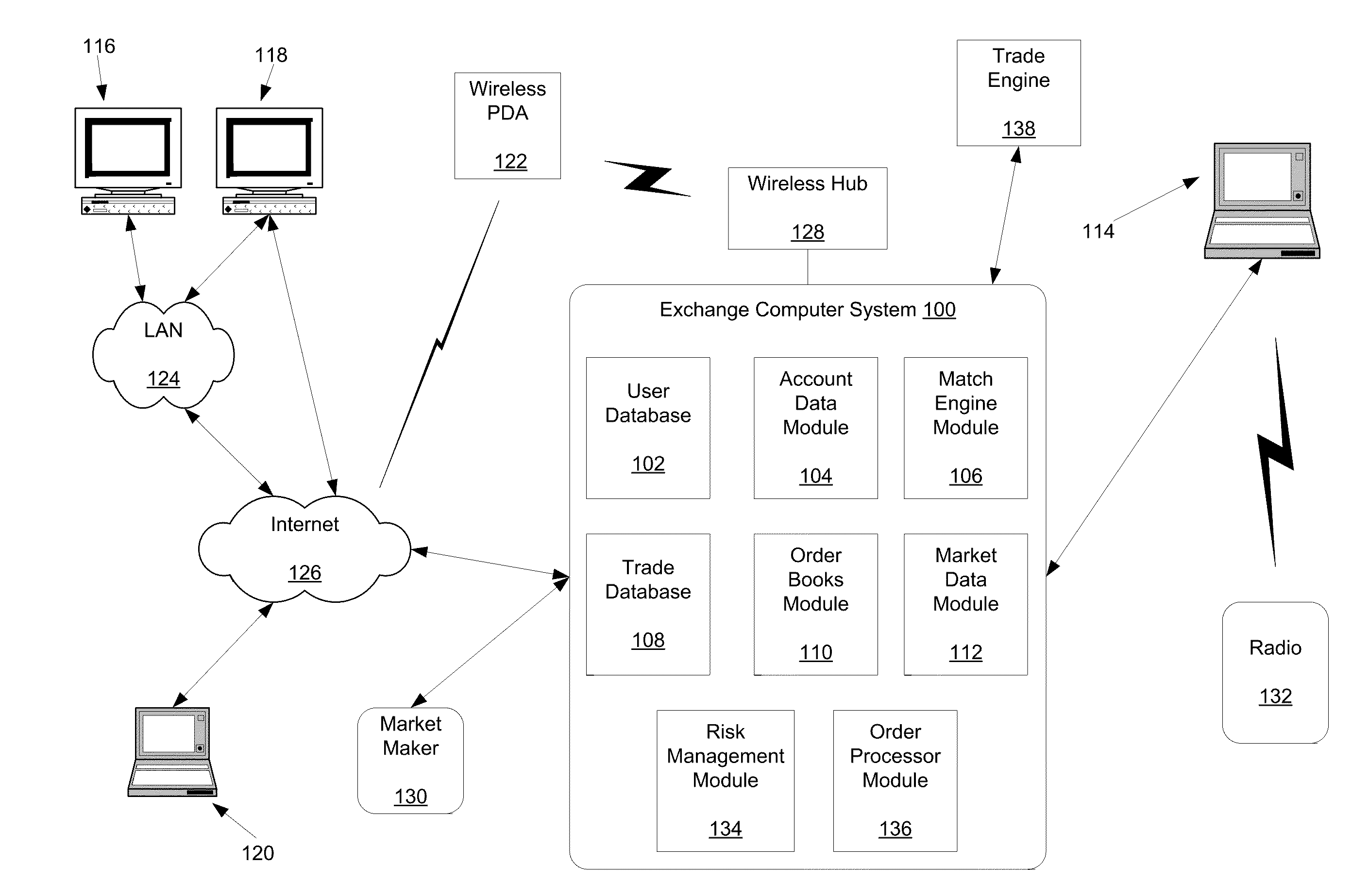

Foreign currency exchange

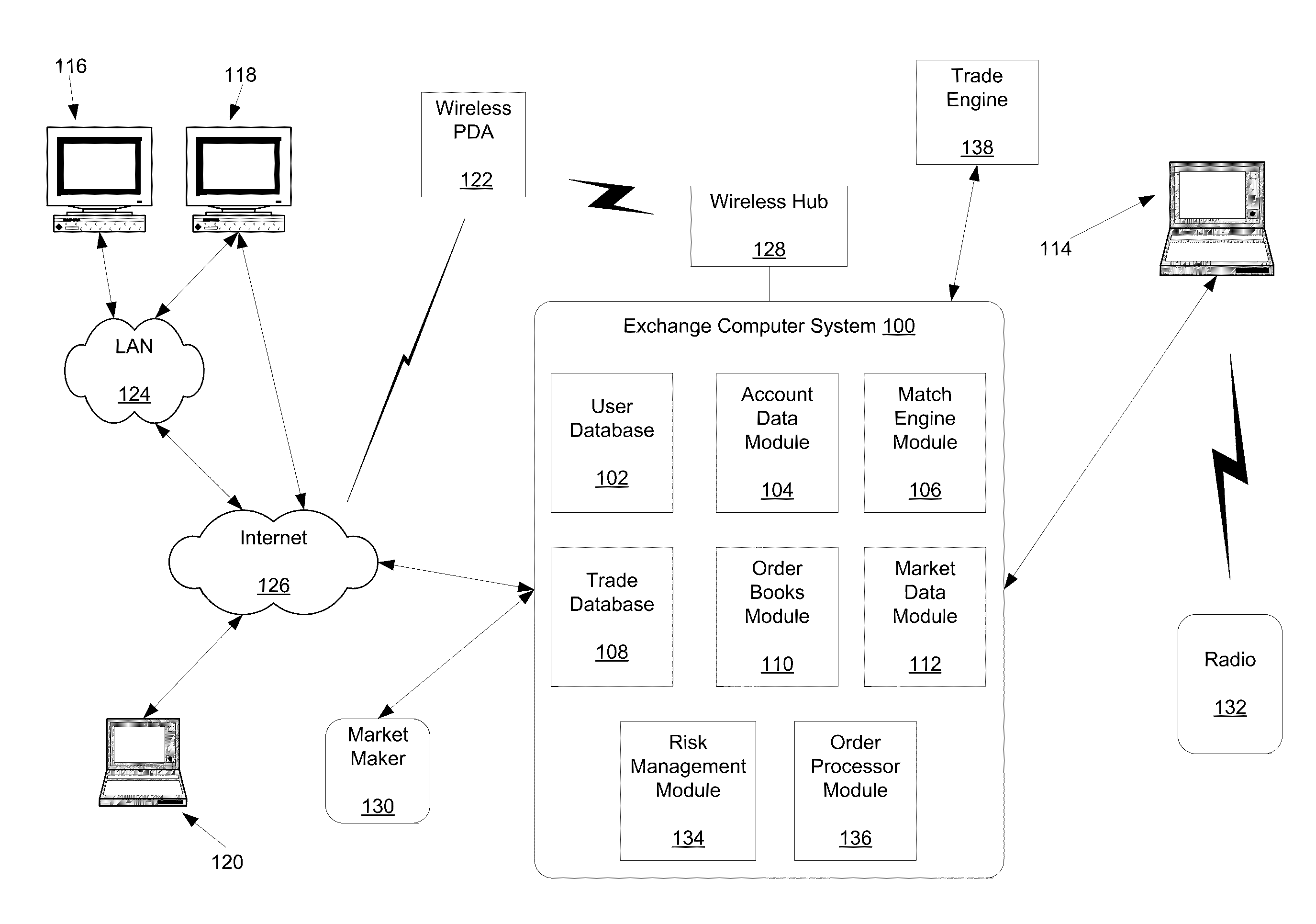

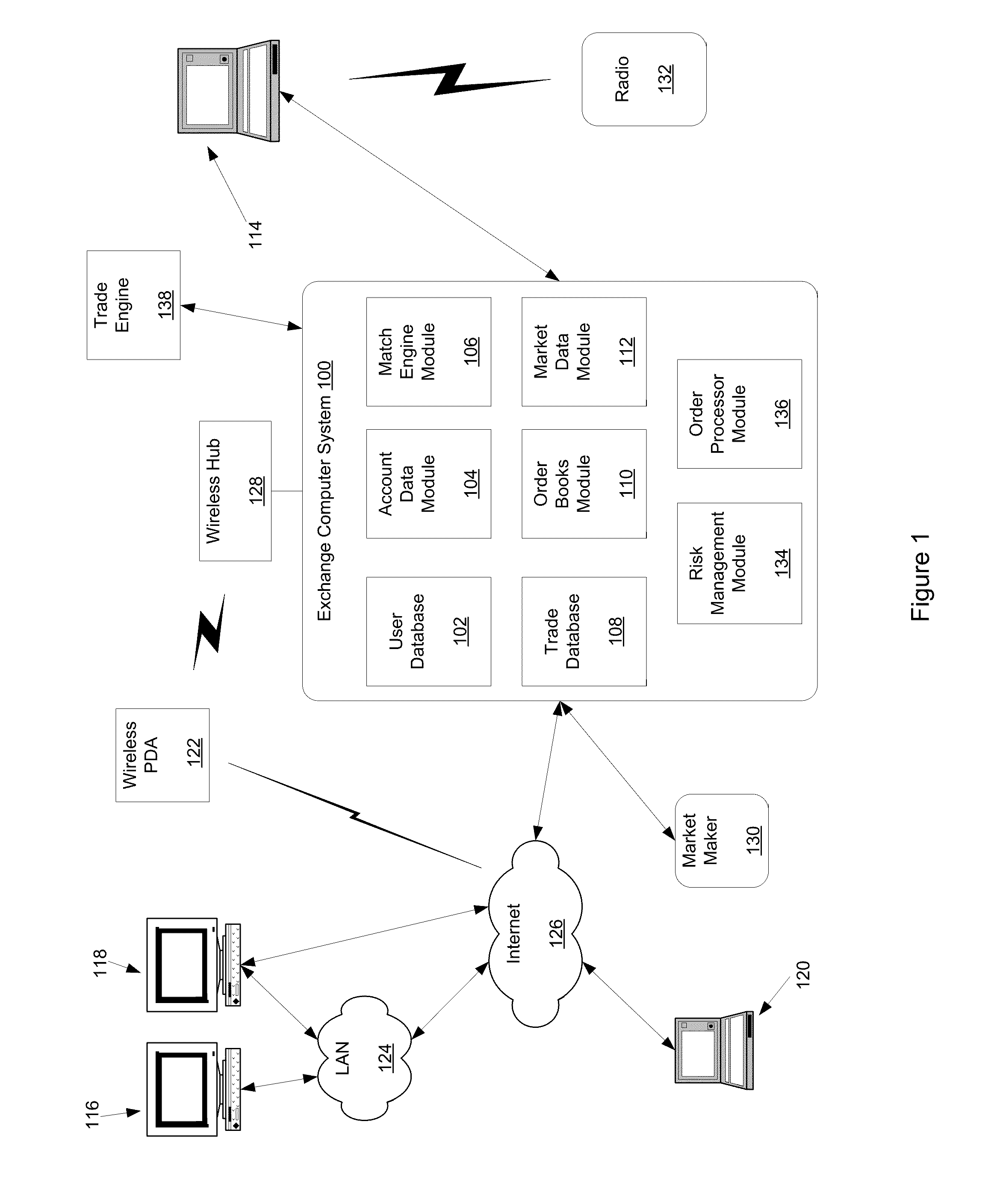

InactiveUS20060173771A1Improving quality and liquidityImprove efficiencyFinancePayment architectureEvent typeEngineering

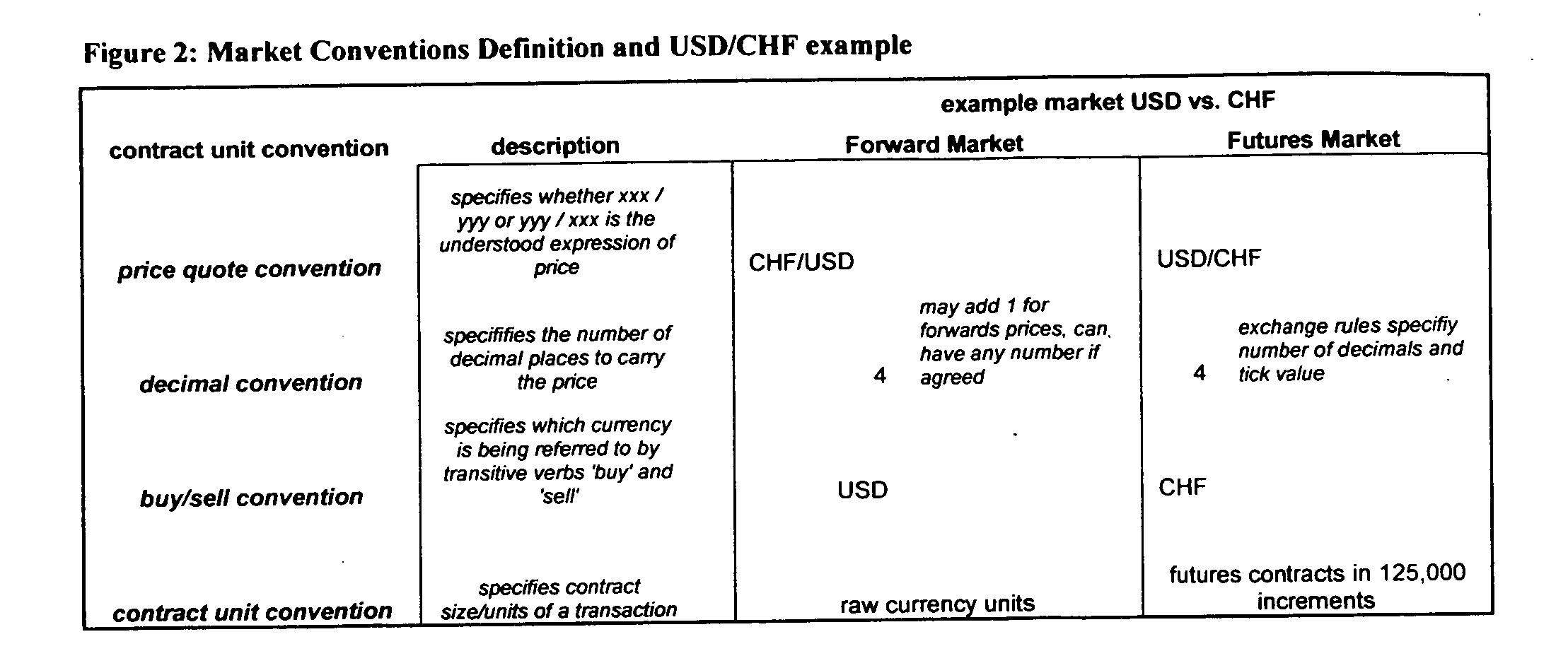

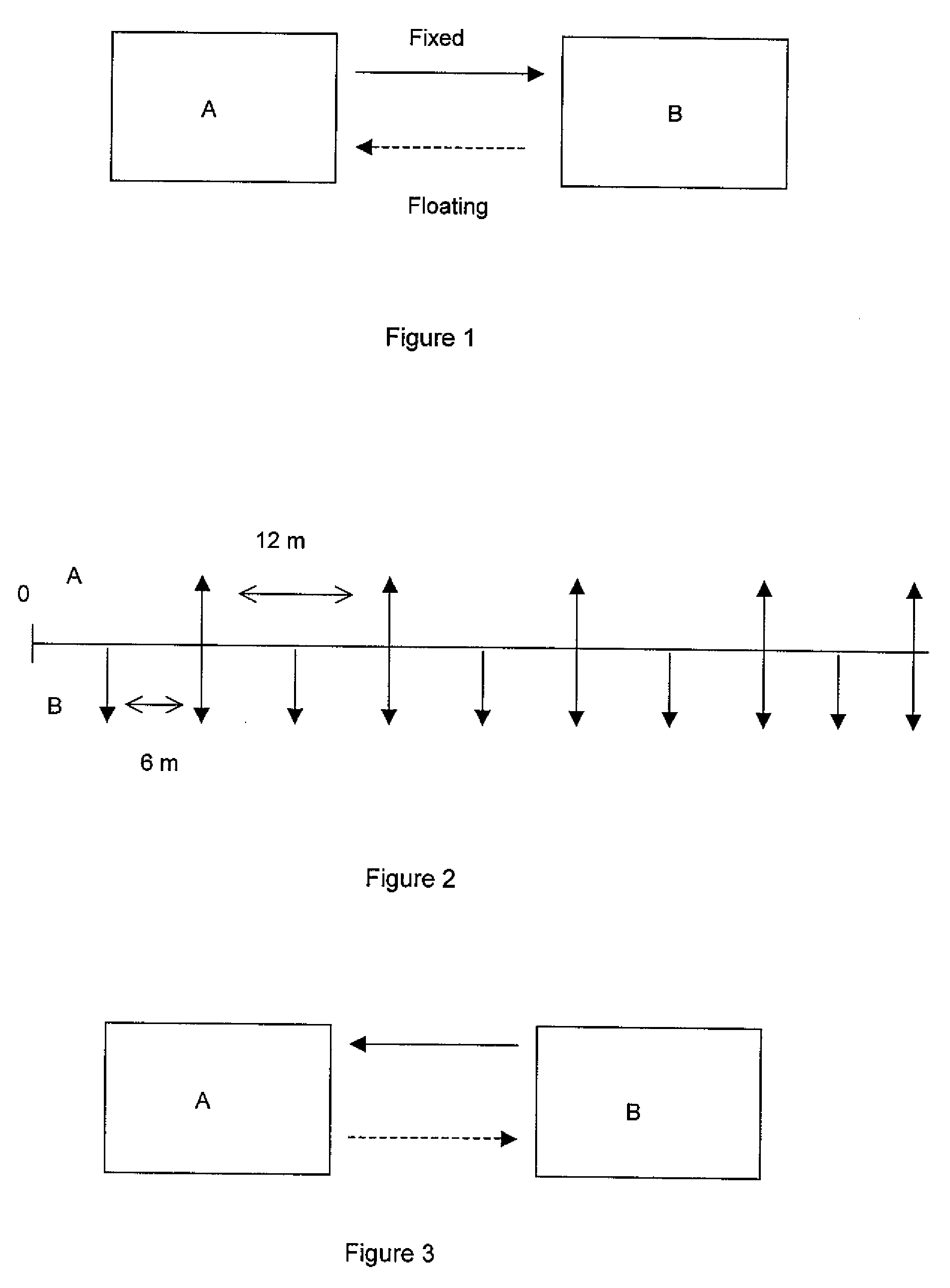

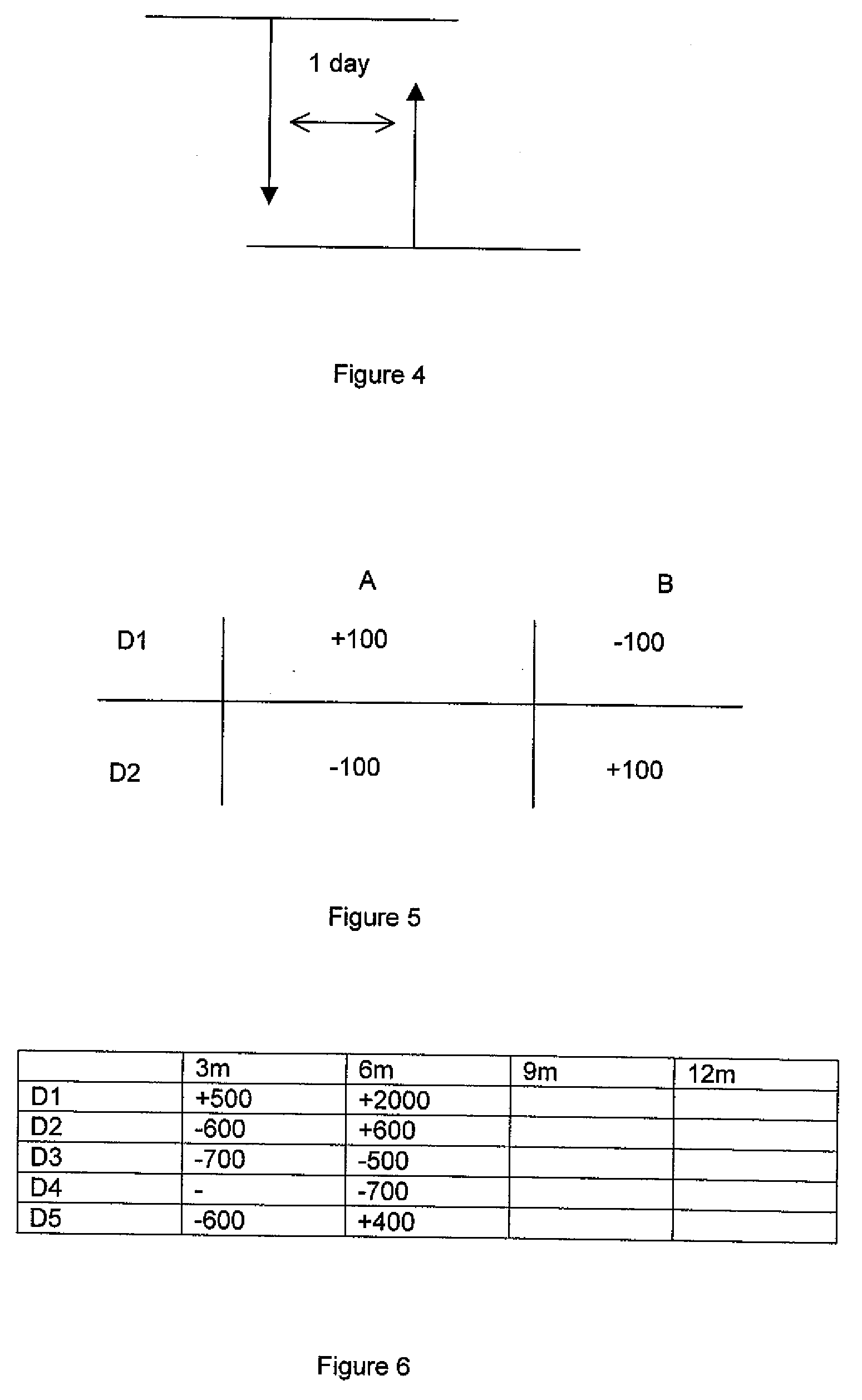

In accordance with the principles of the present invention, a system is provided to help link foreign exchange liquidity at a given settlement date. Exchange trade is represented as a positive product flow and a negative product flow relative to a side of the exchange trade. An exchange relationship between products is defined. A hierarchy of the products is defined. Cross rates to other foreign exchange products in the system are calculated. In accordance with the present invention, a system is provided to integrate spot / forward and swap markets. A forward event type and a swap event type are defined. In a database, spot and other designated dates are defined. Correct settlement dates for the named dates are determined. When an order is entered into the system, the order is entered into an order book, whereby settlement dates are aligned for transactions. In accordance with the present invention, a system is provided to match products in a swap. Products are matched against resting real orders. Products are then matched against resting implied orders with a prioritization scheme. For any residual resting order, implied markets are computed and again checked for matches. When new implieds are generated / checked, if the original order is a ‘spot’ order implieds are generated / checked first along a product axis, then along a date axis. For all other orders, implieds are generated / checked first along the date axis, then the product axis.

Owner:JOHNSTON SCOTT LOCHWOOD

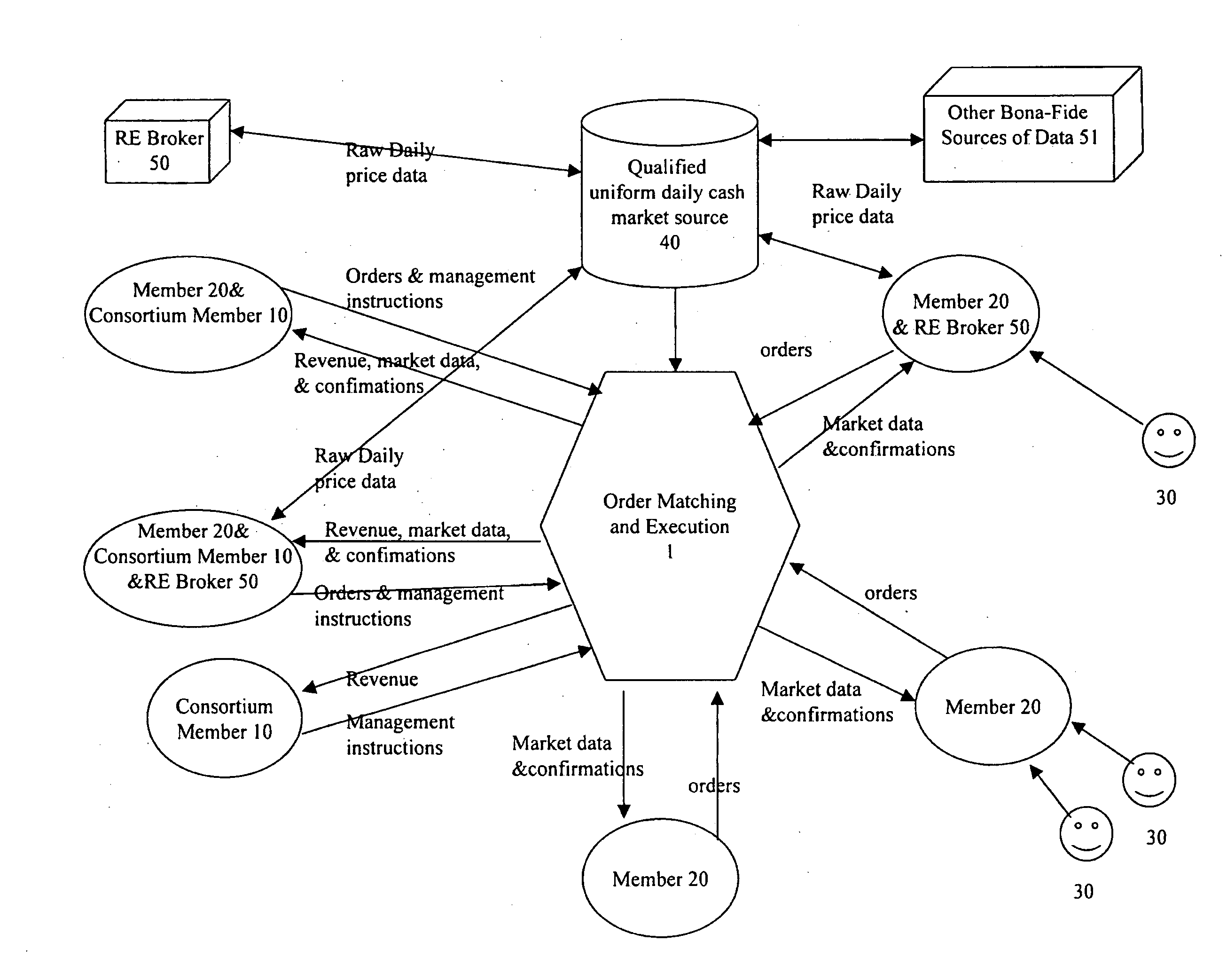

Method for valuing forwards, futures and options on real estate

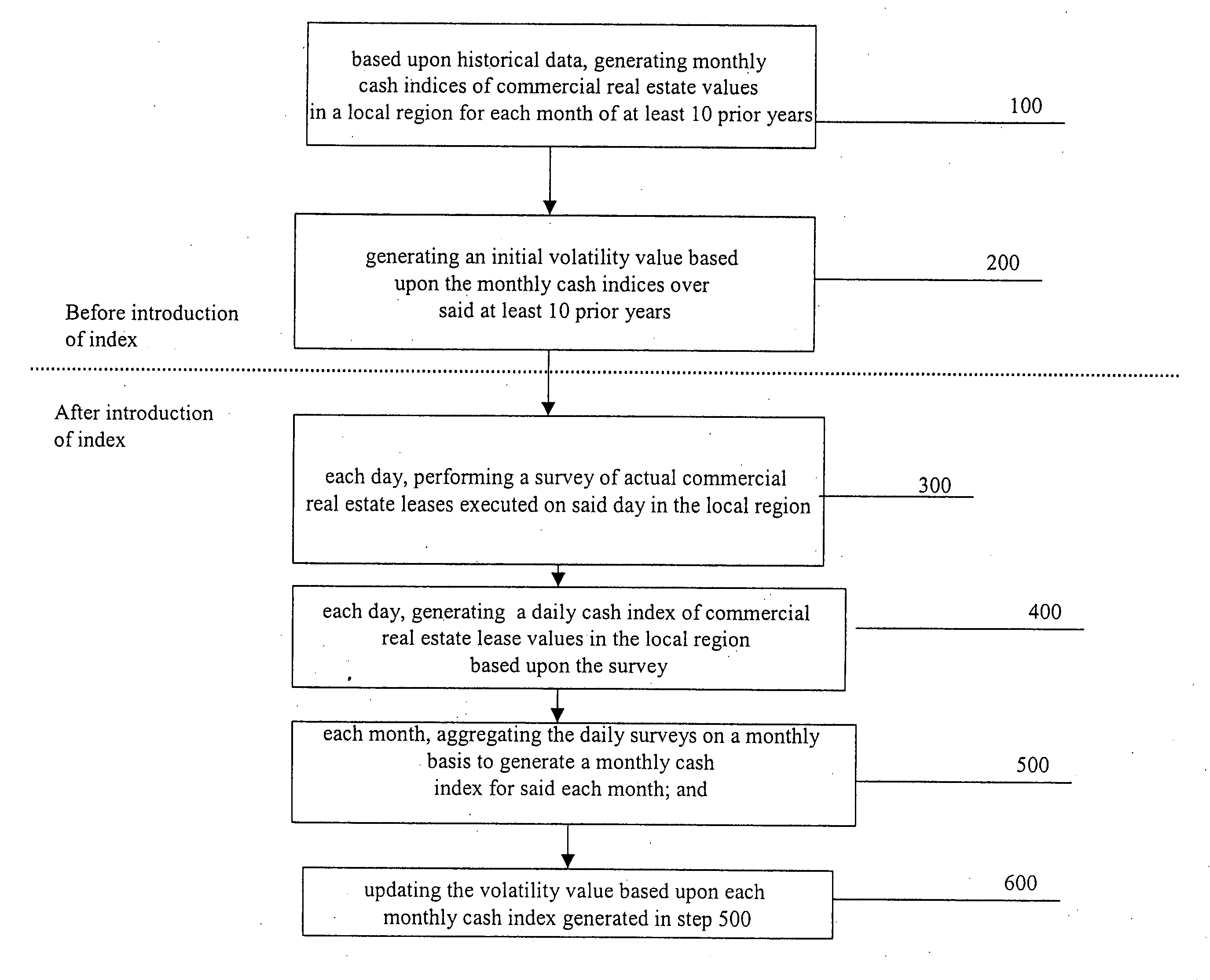

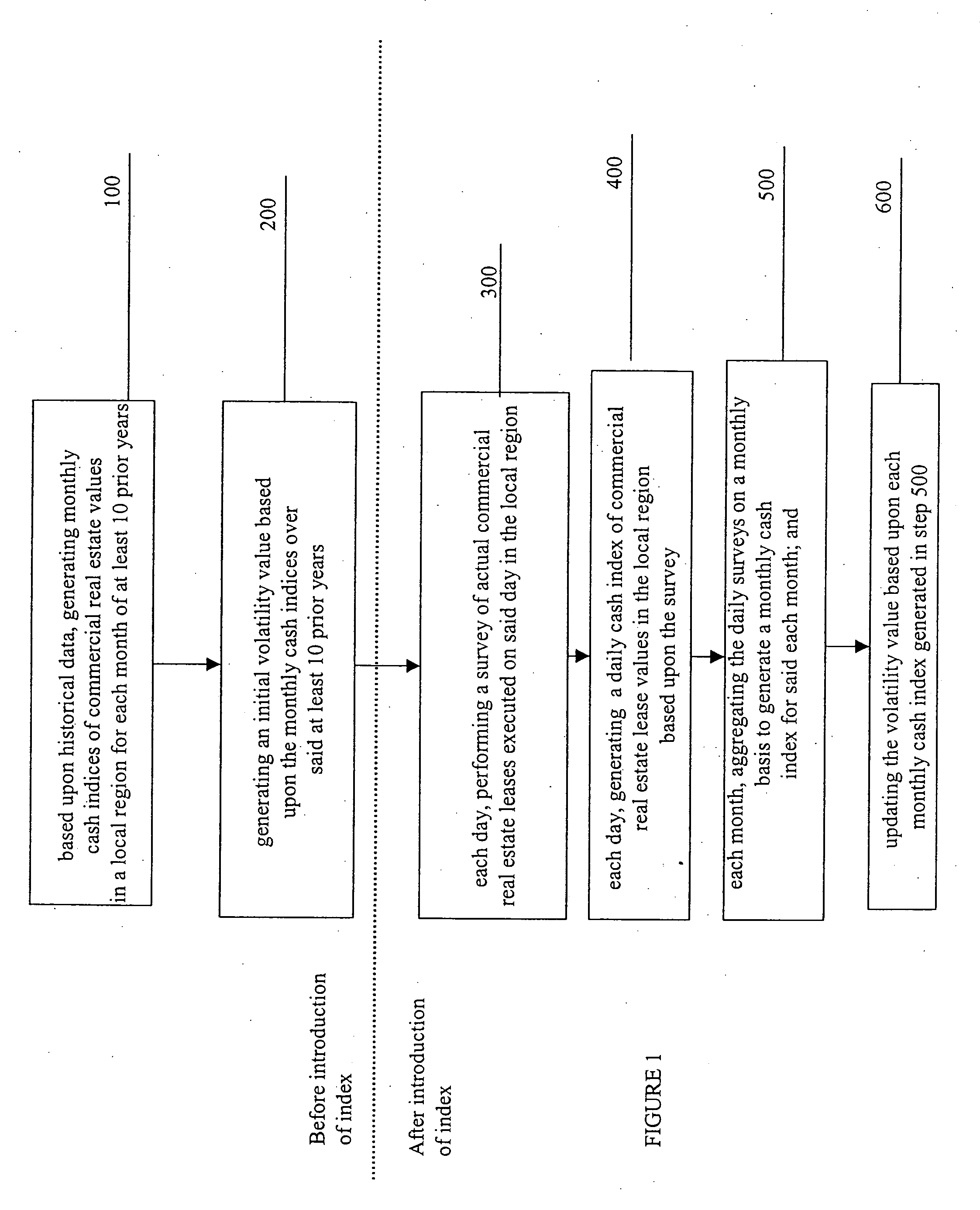

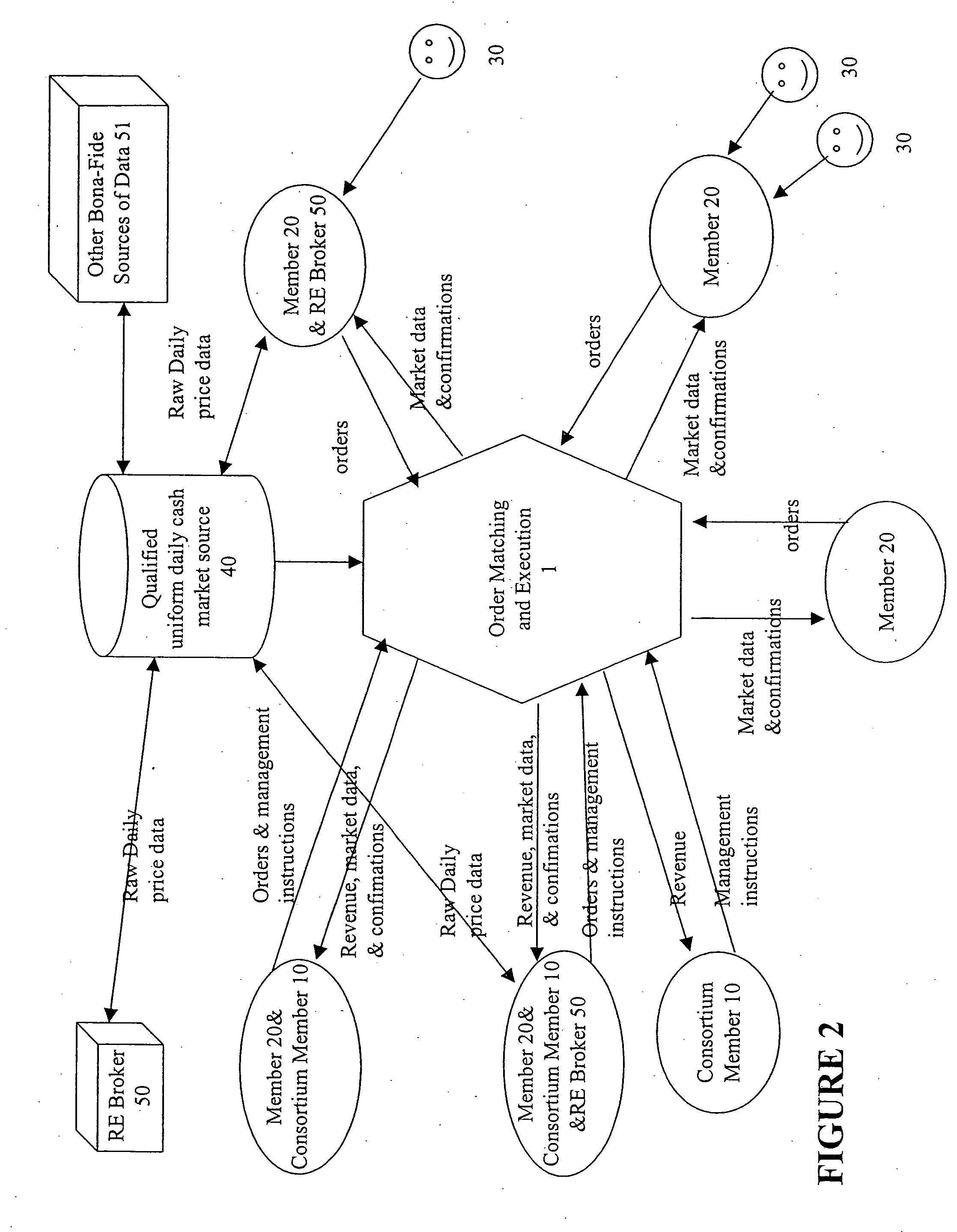

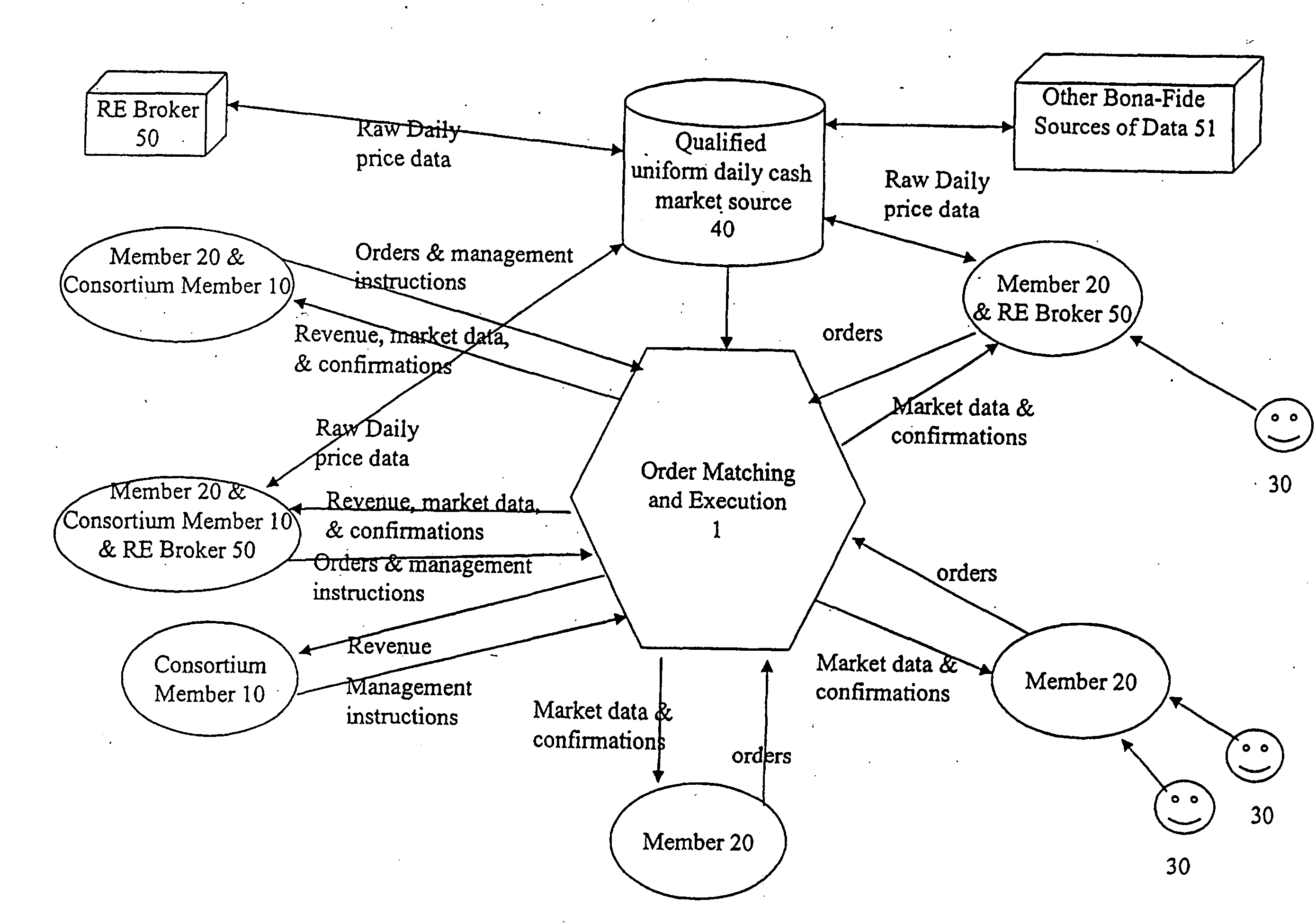

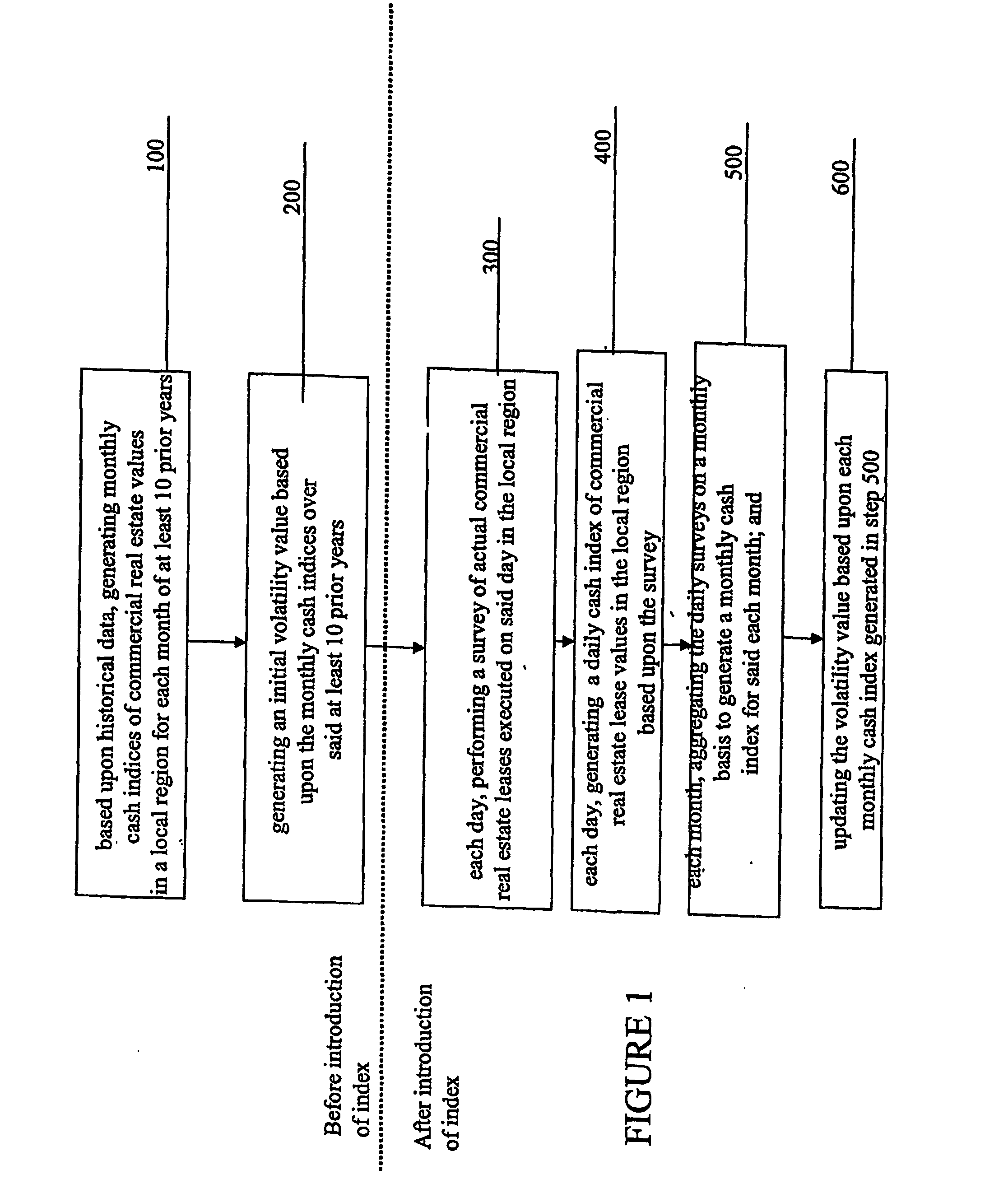

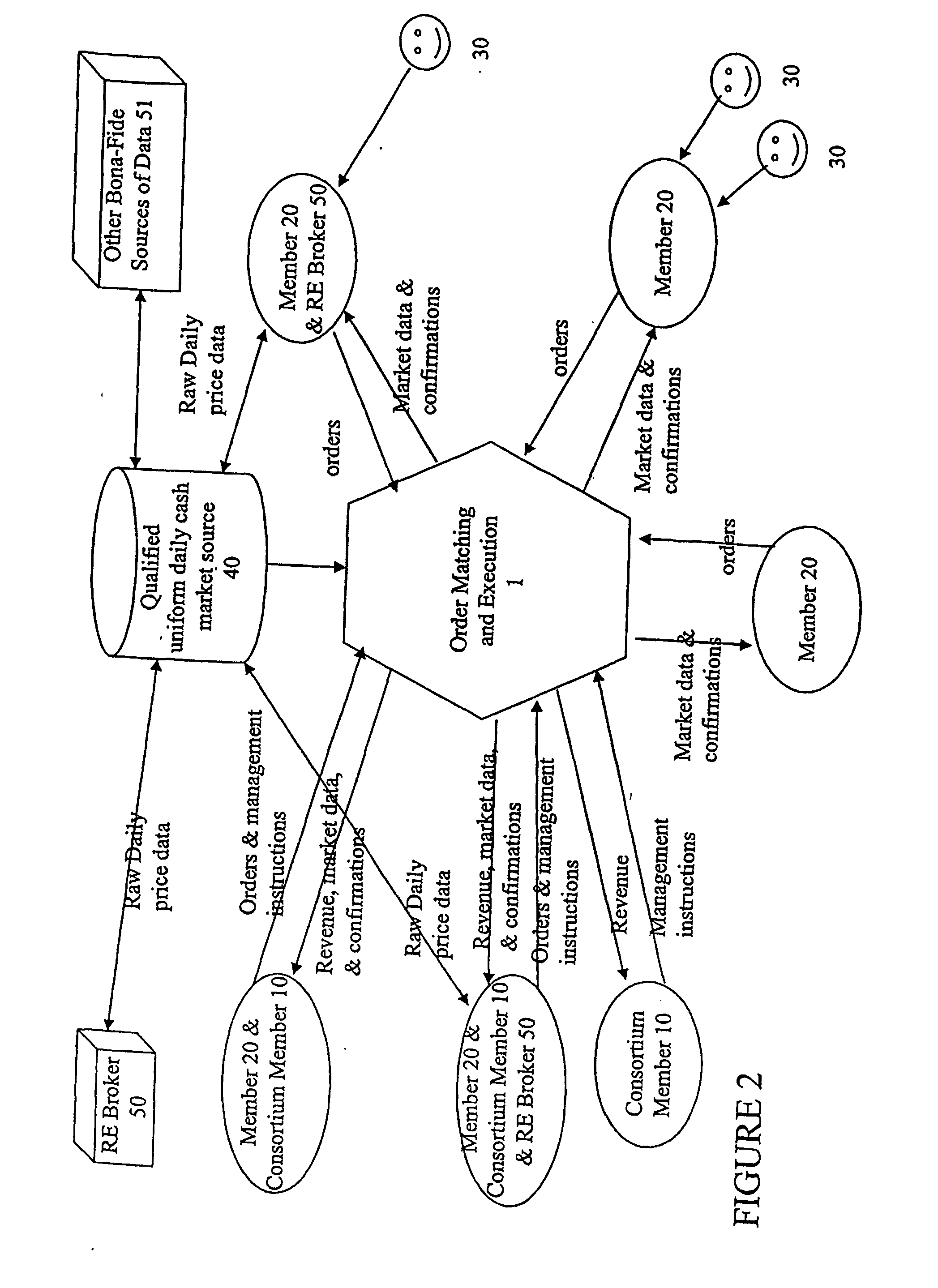

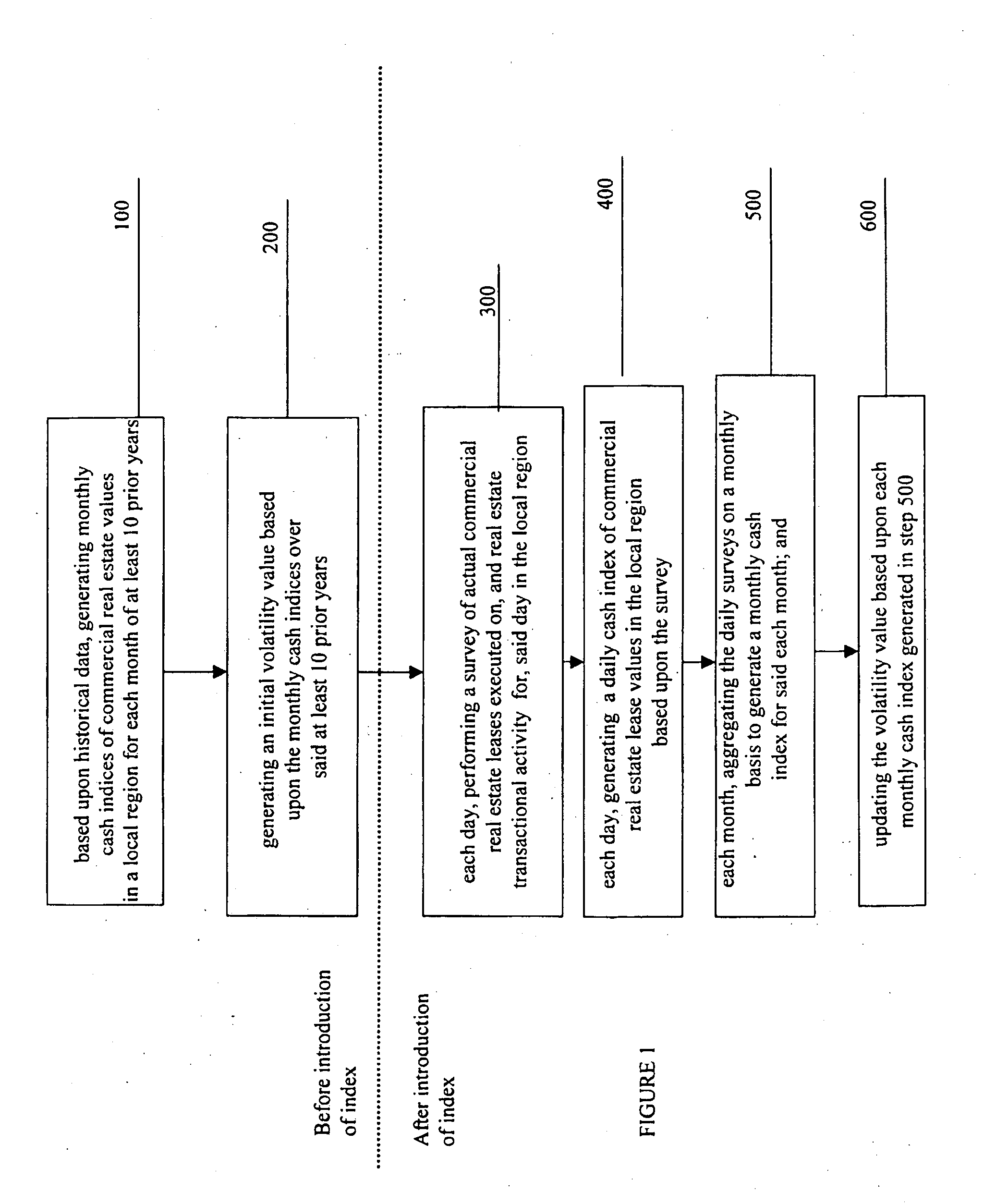

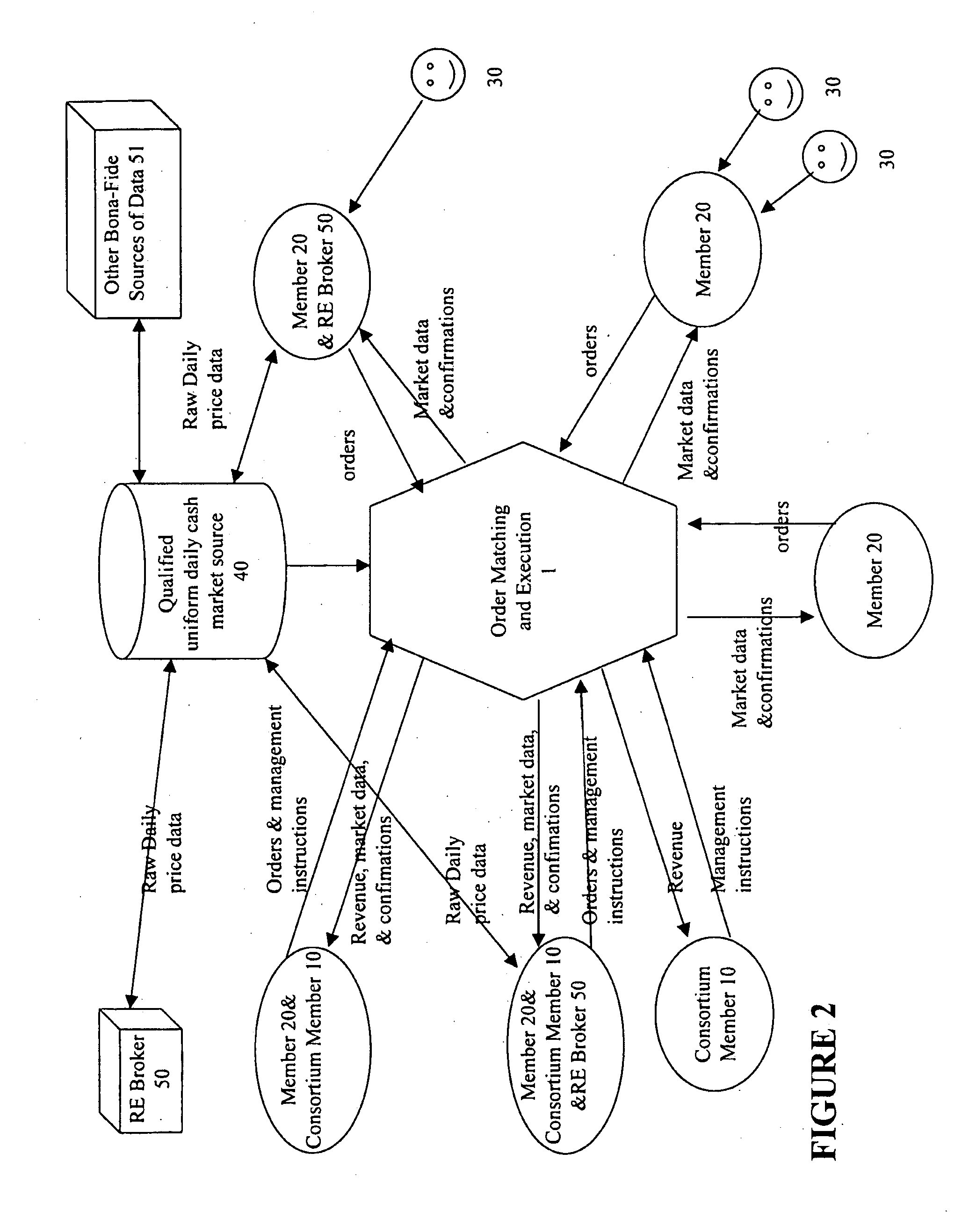

A system and method for matching buy and sell orders is provided. A daily cash index of real estate values for a local region is maintained and a trading instrument representative of an interest in real estate in the local region is created. In this regard, a cash settlement of the trading instrument is a function of the daily cash index on the date of said cash settlement. In addition, a plurality of buy orders relating to the instrument are generated; a plurality of sell orders relating to the instrument are generated; and the buy and sell orders are matched to determine a purchase and sale of the instrument.

Owner:RADAR LOGIC

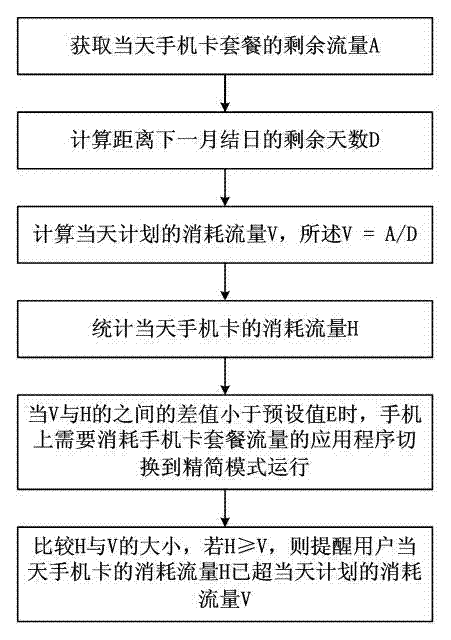

Method for switching internet browsing modes according to surplus flow of mobile phone

ActiveCN103248756AReduce consumptionAvoid the situation of exceeding the mobile phone card package dataSubstation equipmentComputer hardwareThe Internet

The invention discloses a method for switching internet browsing modes according to surplus flow of a mobile phone. The method comprises the following steps: S1, obtaining surplus flow A of the service plan of a phone card on the current date; S2, calculating the number D of the remaining days to the next monthly settlement date; S3, calculating the planned flow consumption V, wherein V equals to A / D; S4, counting the flow consumption H of the phone card on the current date, wherein the flow consumption H of the phone card on the current date is exclusive of any free flow which dose not incur any cost; and S5, when the difference value between V and H is less than a preset value E, switching application programs of the mobile phone, which consume the flow of the service plan of the phone card, to simplified running modes. Through the application of the invention, running modes of application programs such as browsers can be intelligently switched according to the surplus flow, the flow consumption for internet browsing is effectively reduced, and the situation that the flow consumption exceeds the service plan of the phone card is effectively avoided.

Owner:GUANGDONG OPPO MOBILE TELECOMM CORP LTD

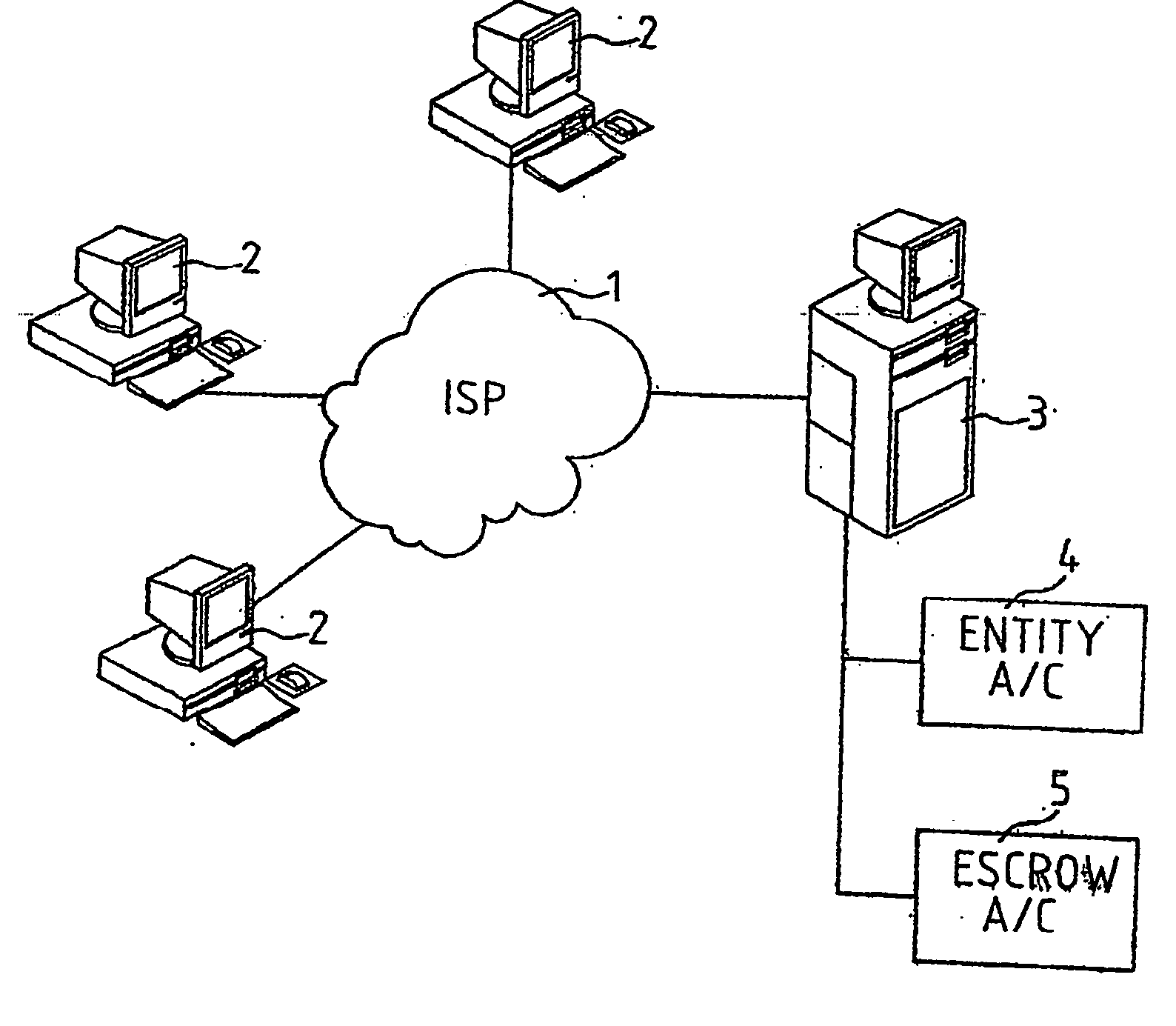

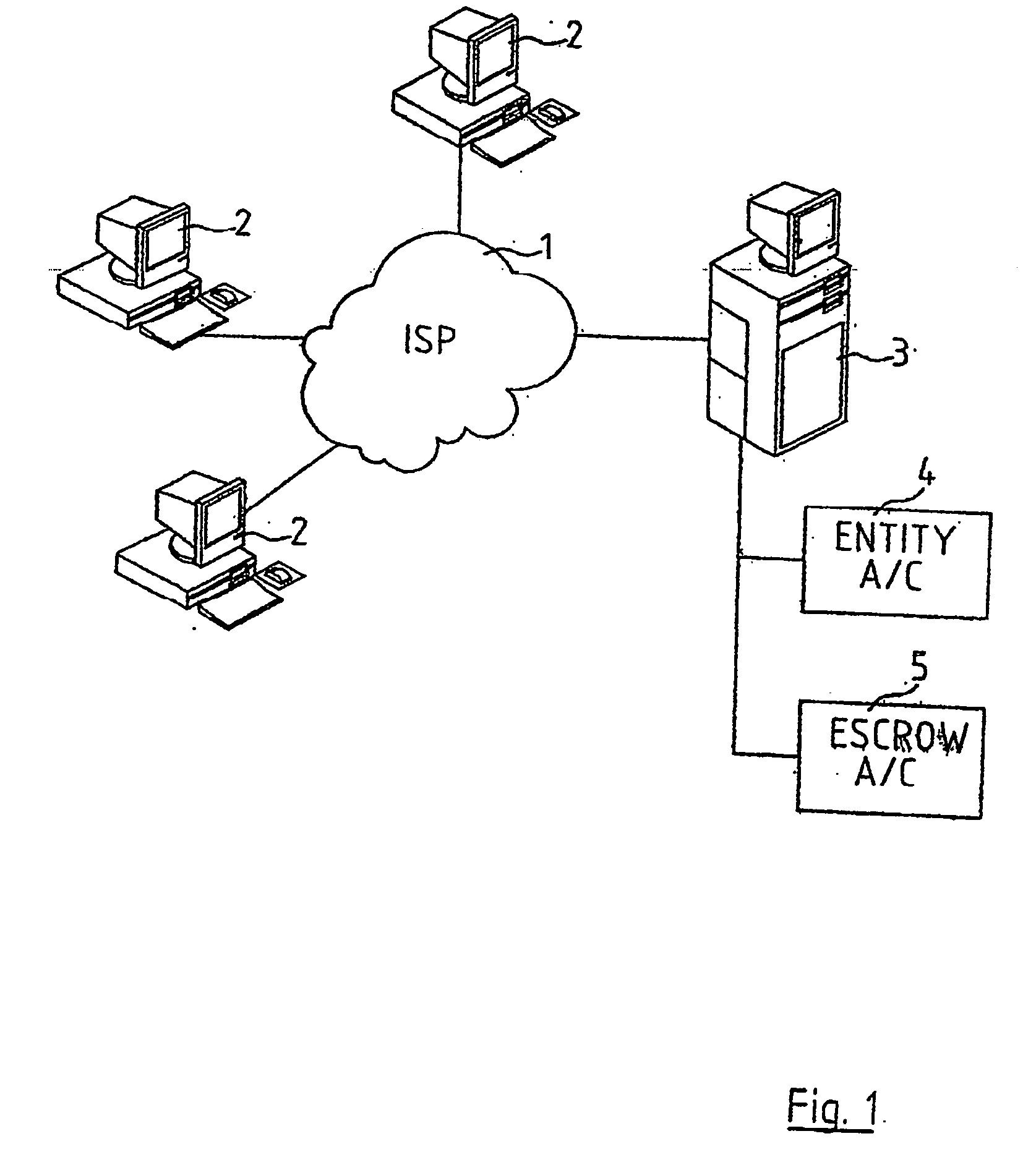

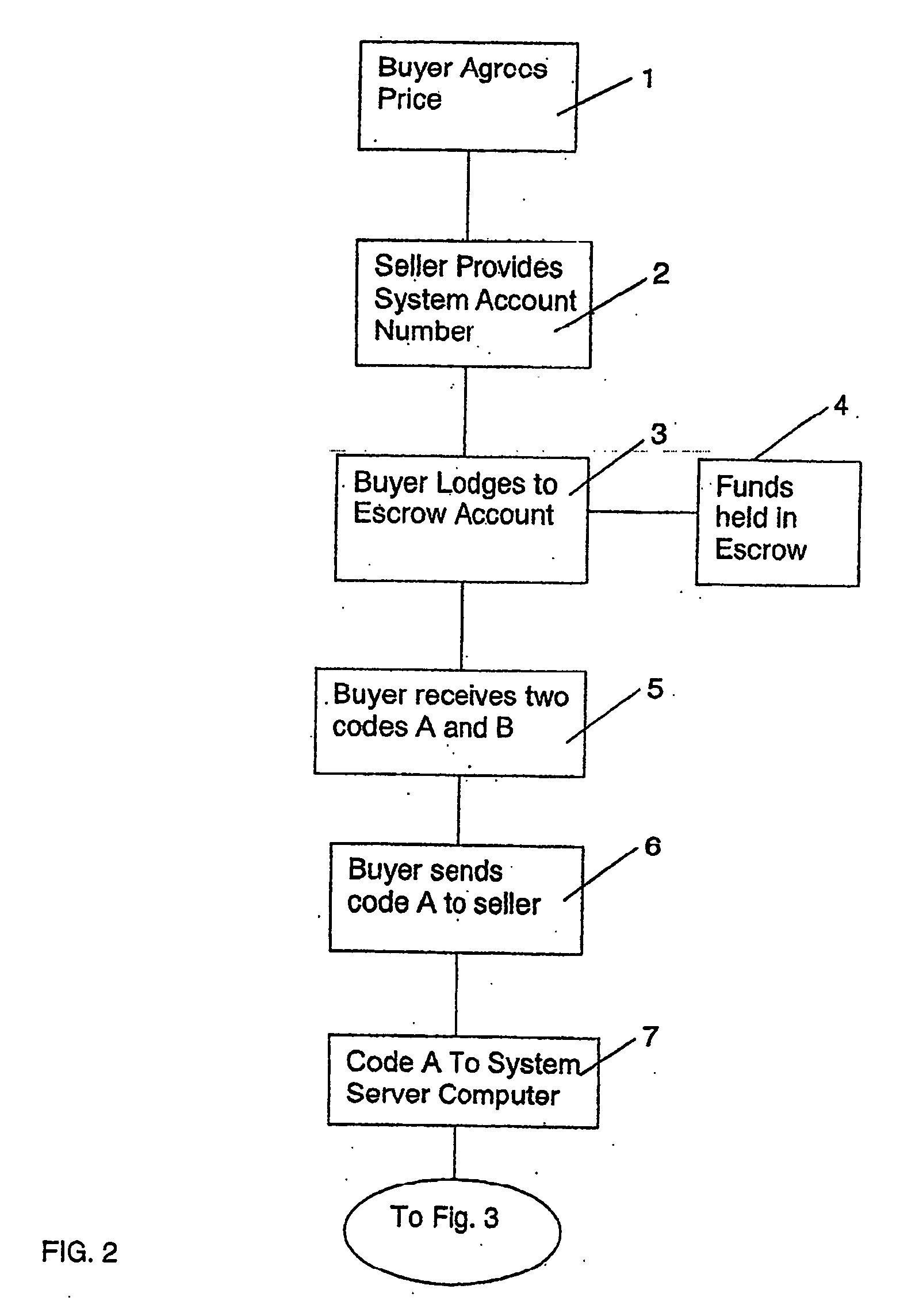

Funds transfer method and system

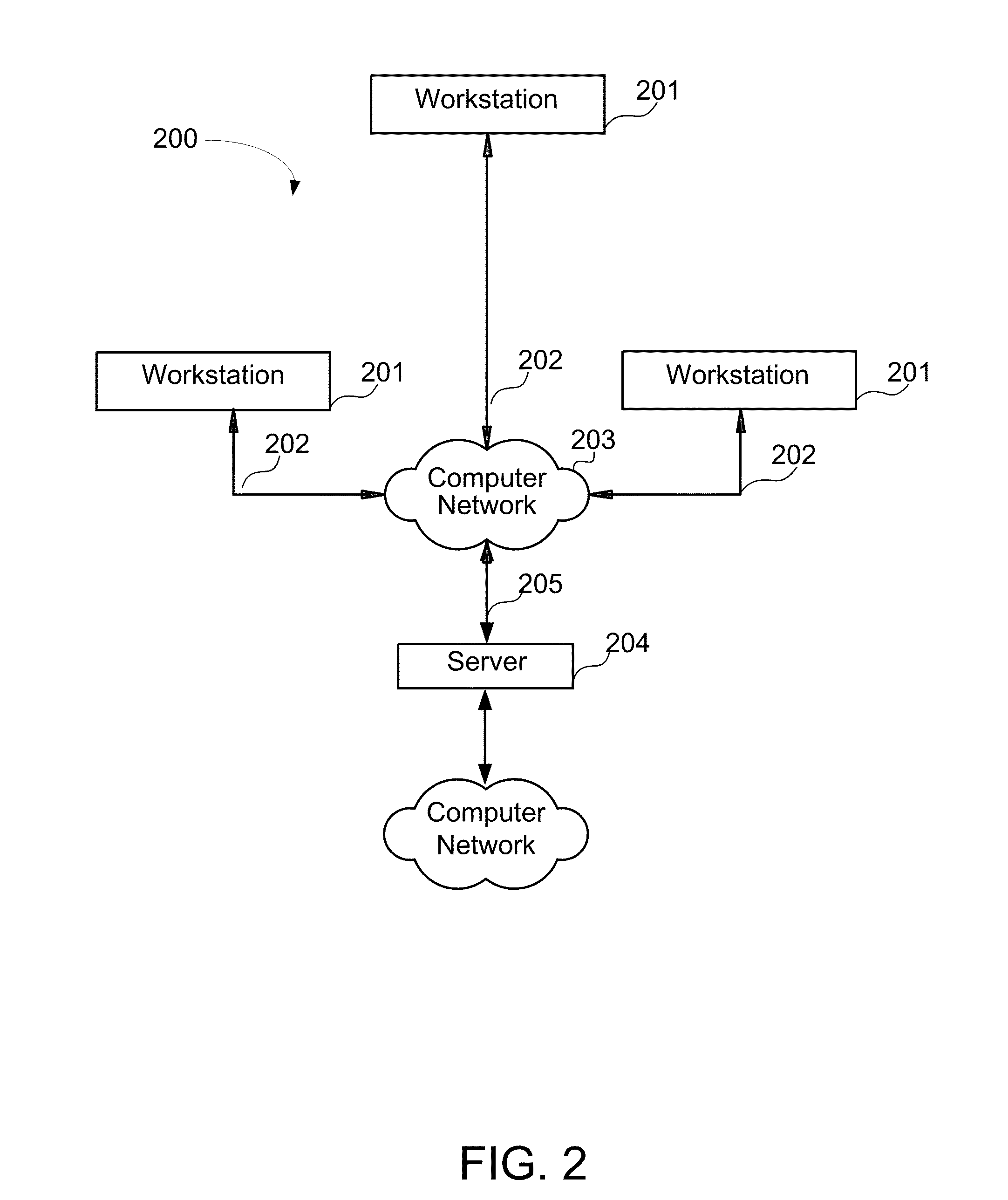

InactiveUS20050246268A1Raise the possibilityEasy and efficientFinancePayment circuitsCommunications systemThe Internet

Owner:INTERNET PAYMENTS PATENTS

Method for valuing forwards, futures and options on real estate

A system and method for matching buy and sell orders is provided. A daily cash index of real estate values for a local region is maintained and a trading instrument representative of an interest in real estate in the local region is created. In this regard, a cash settlement of the trading instrument is a function of the daily cash index on the date of said cash settlement. In addition, a plurality of buy orders relating to the instrument are generated; a plurality of sell orders relating to the instrument are generated; and the buy and sell orders are matched to determine a purchase and sale of the instrument.

Owner:RADAR LOGIC

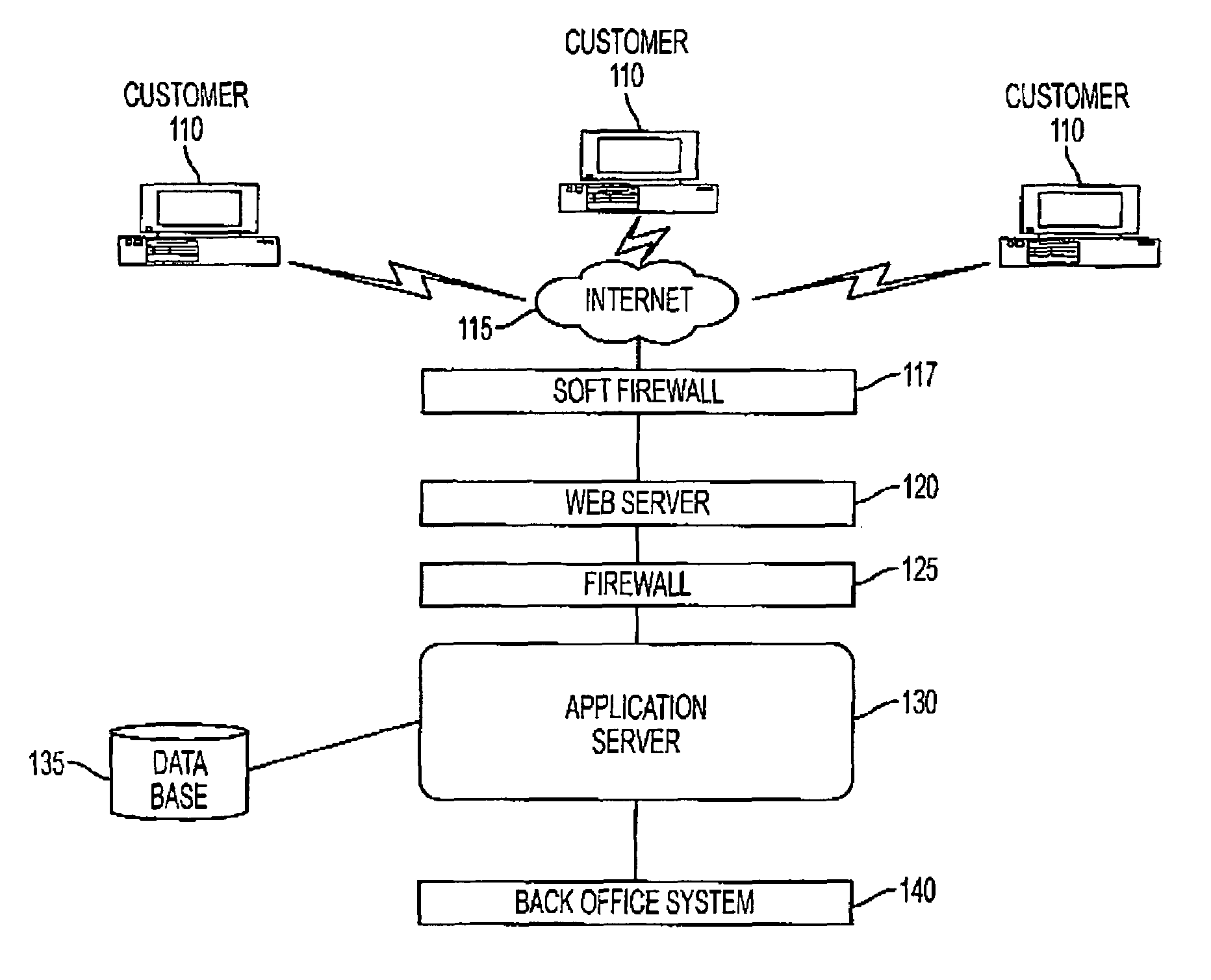

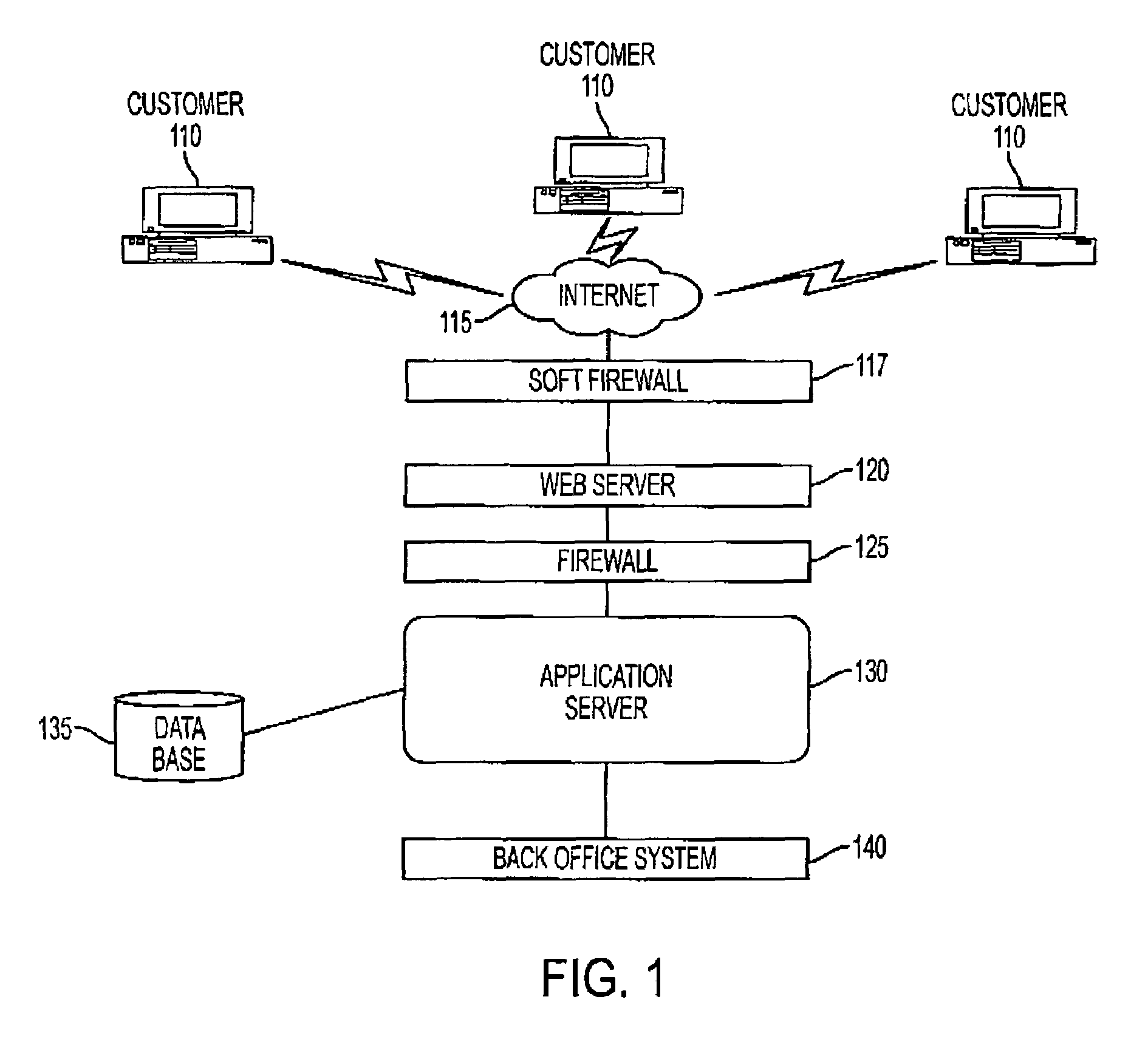

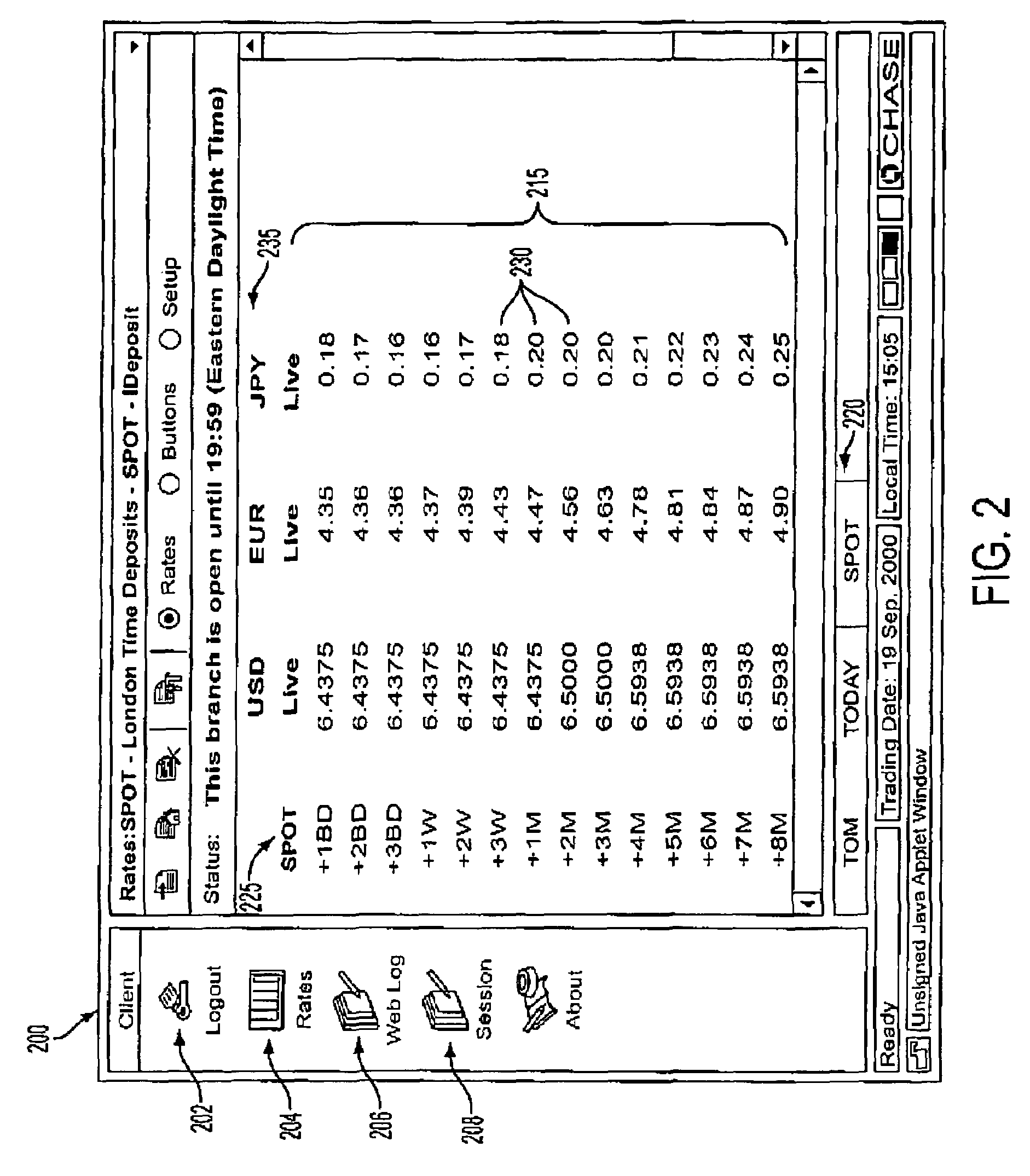

System and method for executing deposit transactions over the internet

ActiveUS7249095B2Ensure safety and confidentialityFinancePayment architectureGraphicsGraphical user interface

A system and method for initiating and processing banking deposits. In a preferred embodiment, the system is maintained by a financial institution such as a bank and the bank customers access the system through the Internet. A typical bank customer is a corporate treasurer. The system provides a Graphical User Interface that allows the customers to view the bank's current rates for a plurality of currencies and a plurality of time periods. The time periods for the deposits typically range from overnight to several months. Once the customer has found a time period / rate / currency that is acceptable, the customer selects the desired rate on the customer interface and the system automatically generates a deal ticket that is presented to the customer. The customer can then modify the settlement date, the settlement instructions and the amount of the deposit. Once the customer is satisfied with the deal, the customer submits it for trading. In an important aspect of the present invention, the confirmation of the trade occurs online and real time. Once the customer accepts the deal, it is logged. The system has further utilities for the customers to view archives of previous deals, establish profiles and preferences and chat with bank representatives. The system further includes state of the art security in order to ensure the safety and confidentiality of the banking transactions.

Owner:JPMORGAN CHASE BANK NA

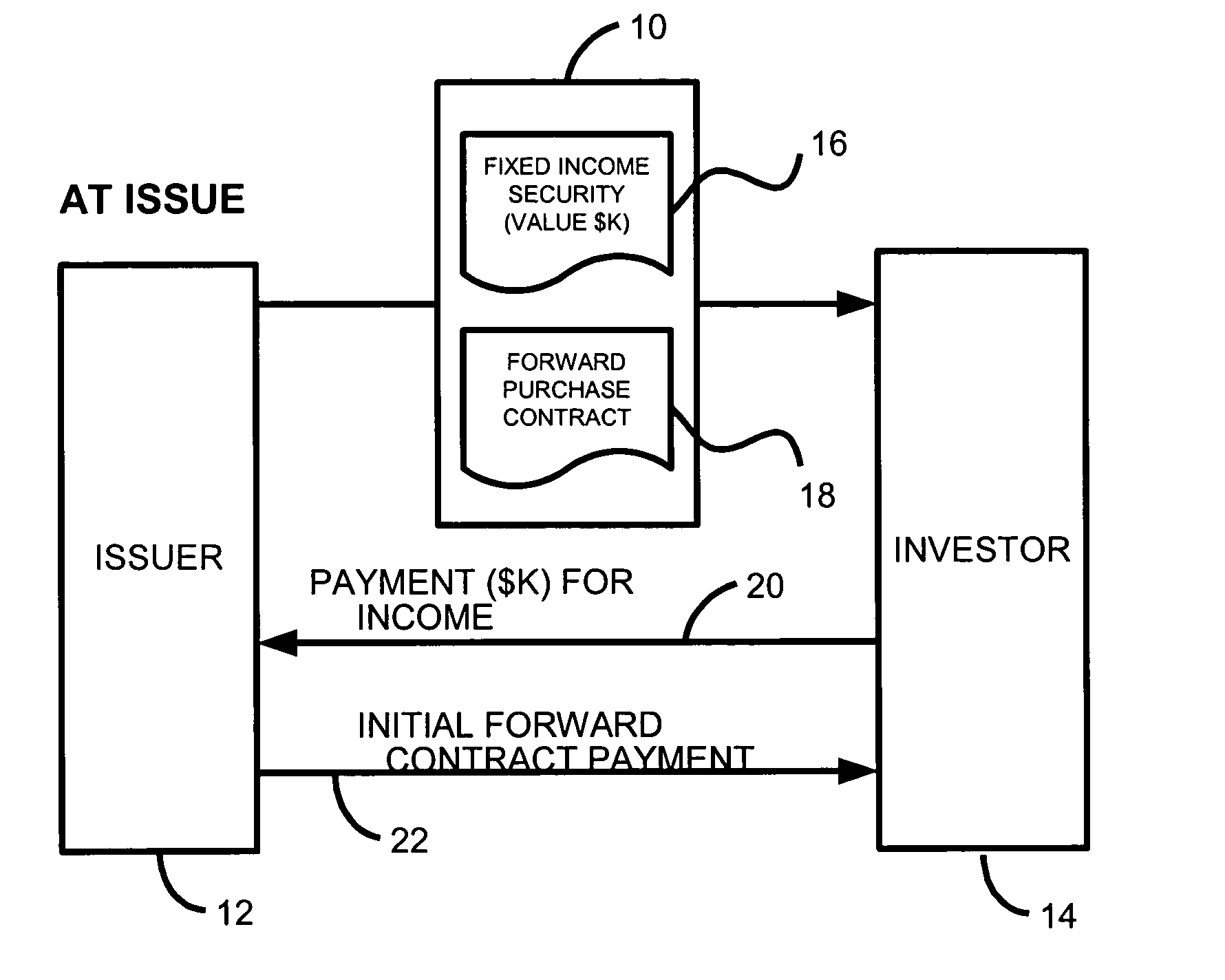

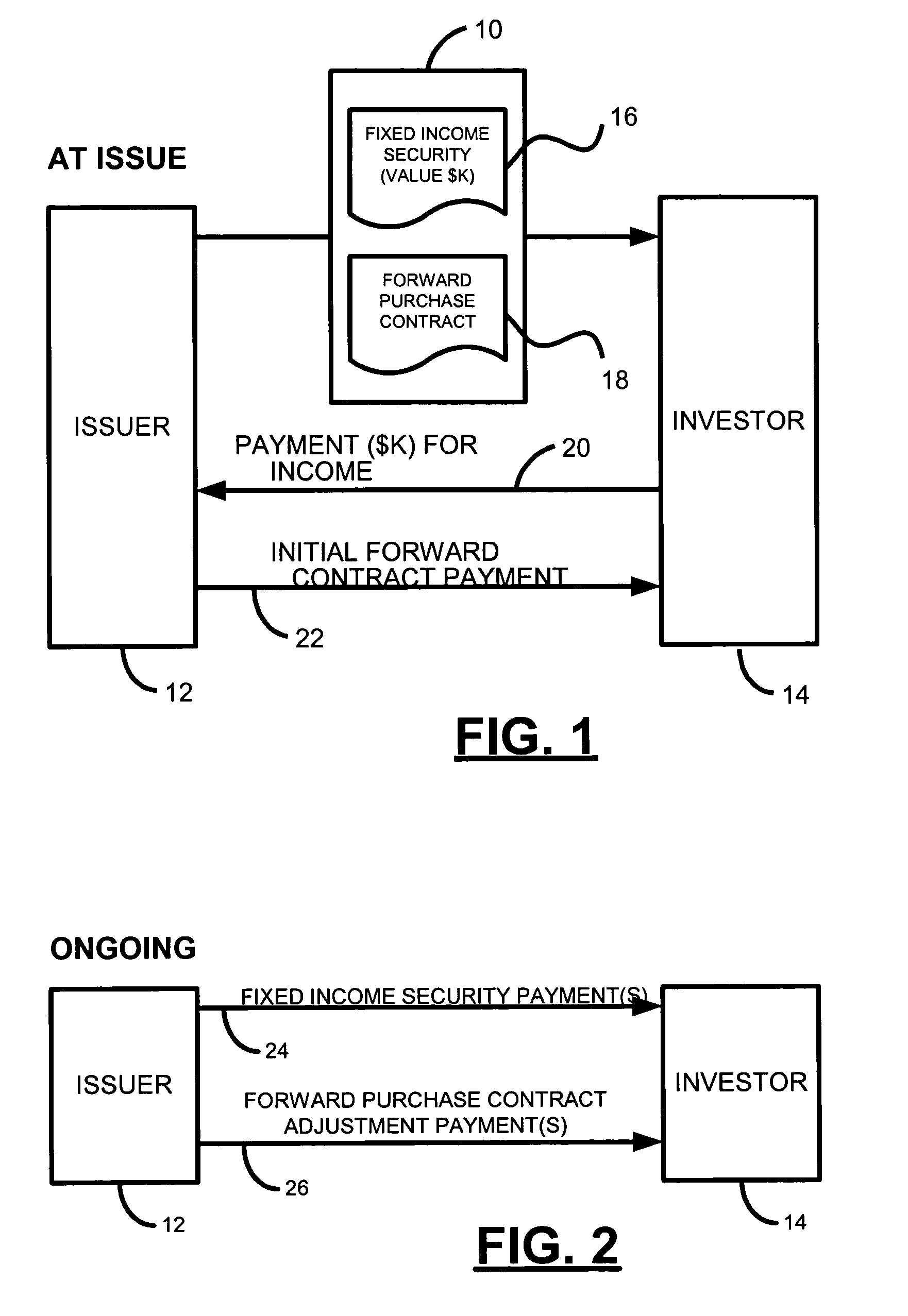

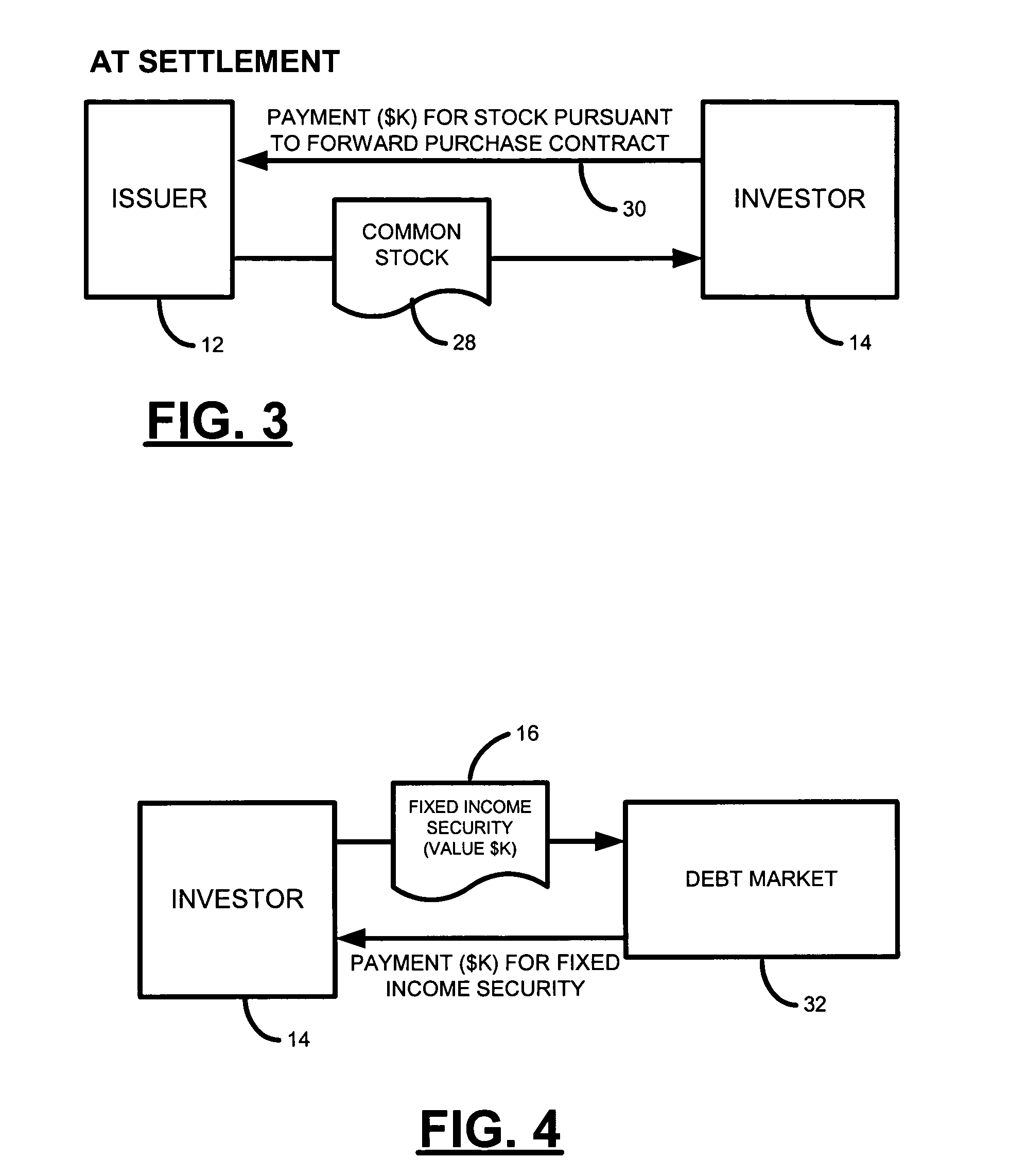

Enhanced premium equity participating securities

InactiveUS20050075976A1Great tax advantageConvenient amountFinancePayment architectureEngineeringSettlement date

A financial unit is disclosed. According to one embodiment the unit includes a fixed income security and a forward purchase contract. The fixed income security may include a maturity date, a principal amount and an interest amount. The forward purchase contract may obligate a holder of the forward purchase contract to purchase a quantity of equity securities of an issuer of the unit for a price equal to the stated amount of the unit no later than a settlement date specified in the forward purchase contract. In addition, the forward purchase contract may further obligate the issuer of the unit to pay a purchaser of the unit a forward purchase contract payment at issuance of the unit and possibly additional forward contract payments after issuance.

Owner:MORGAN STANLEY

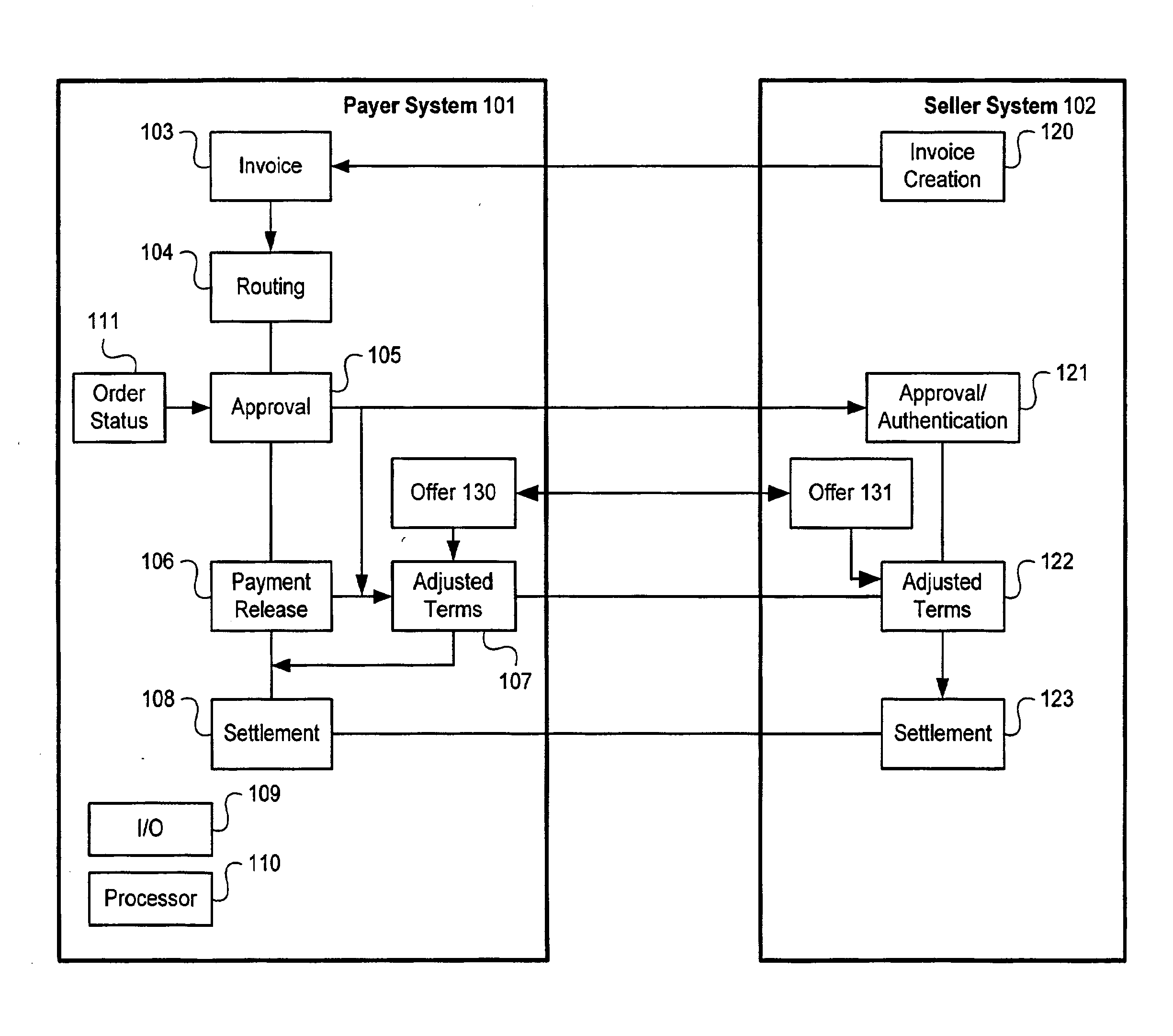

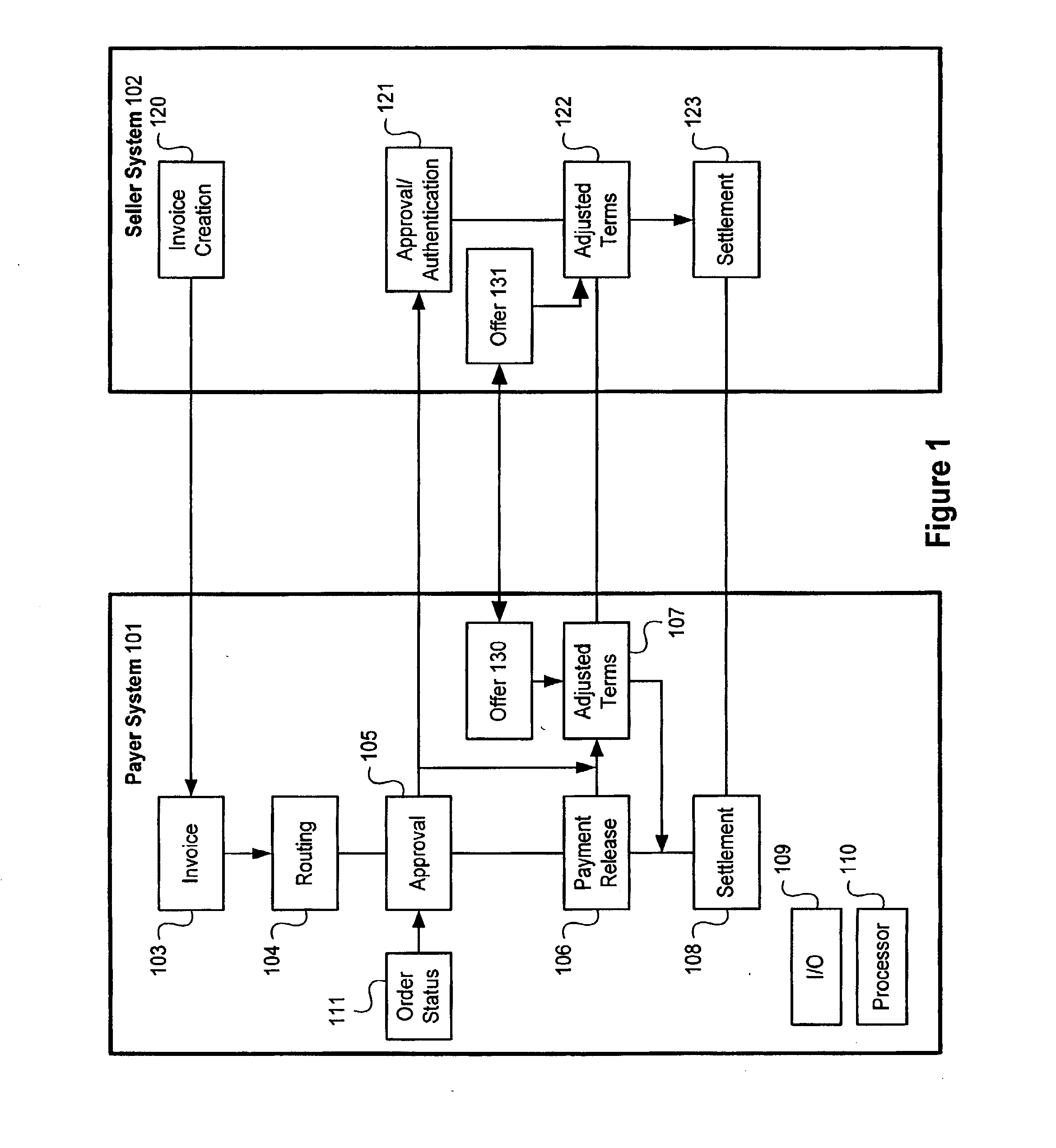

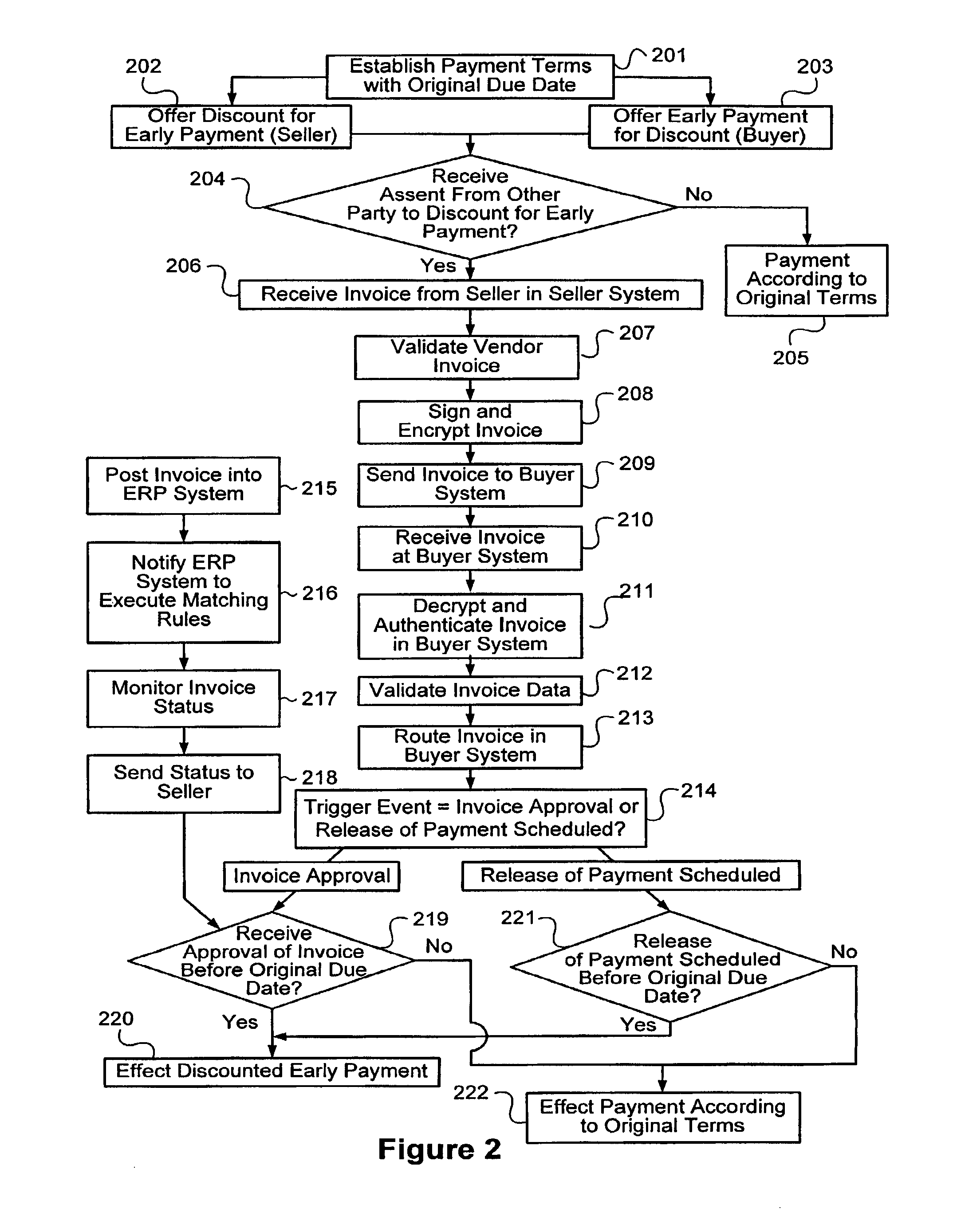

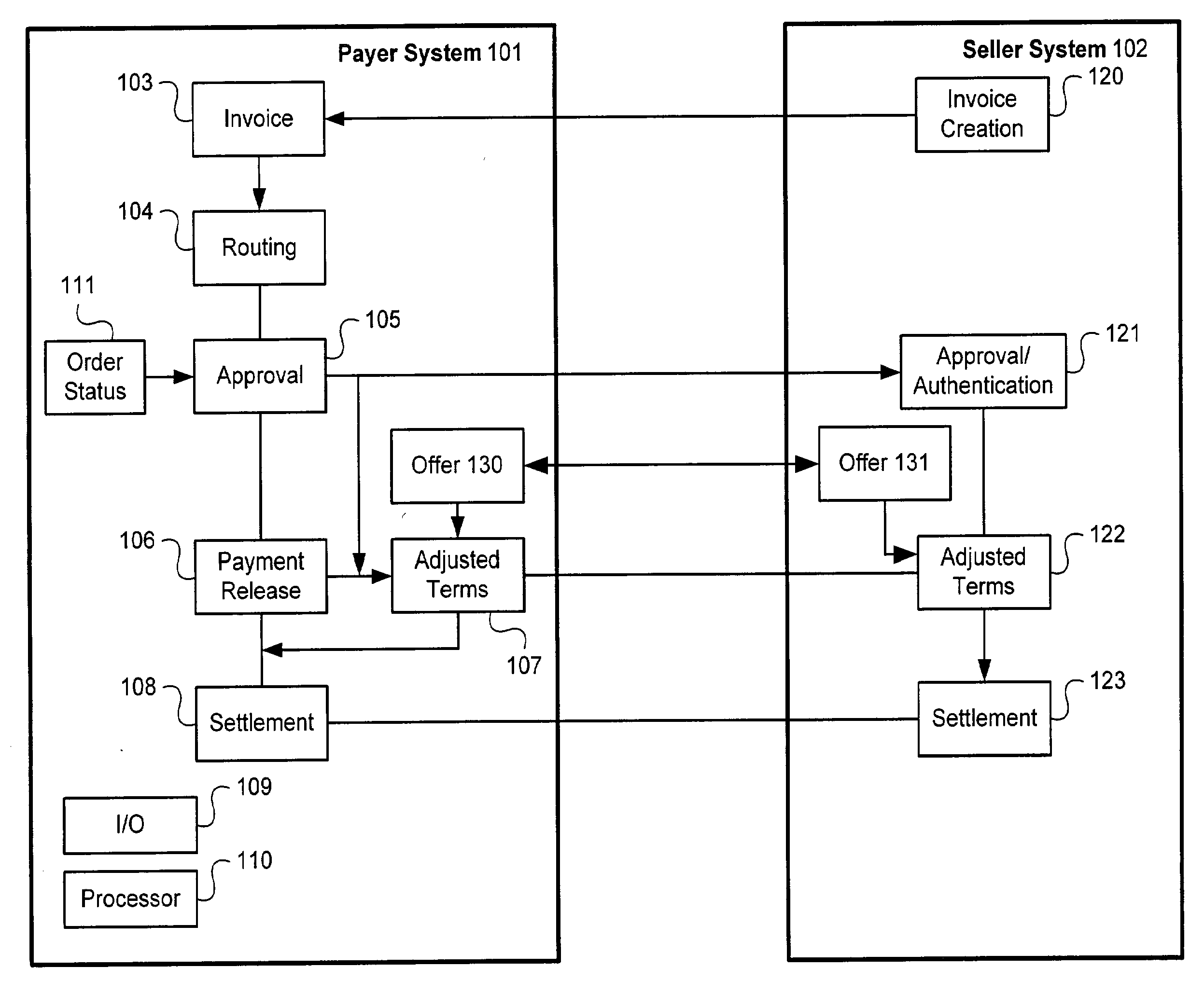

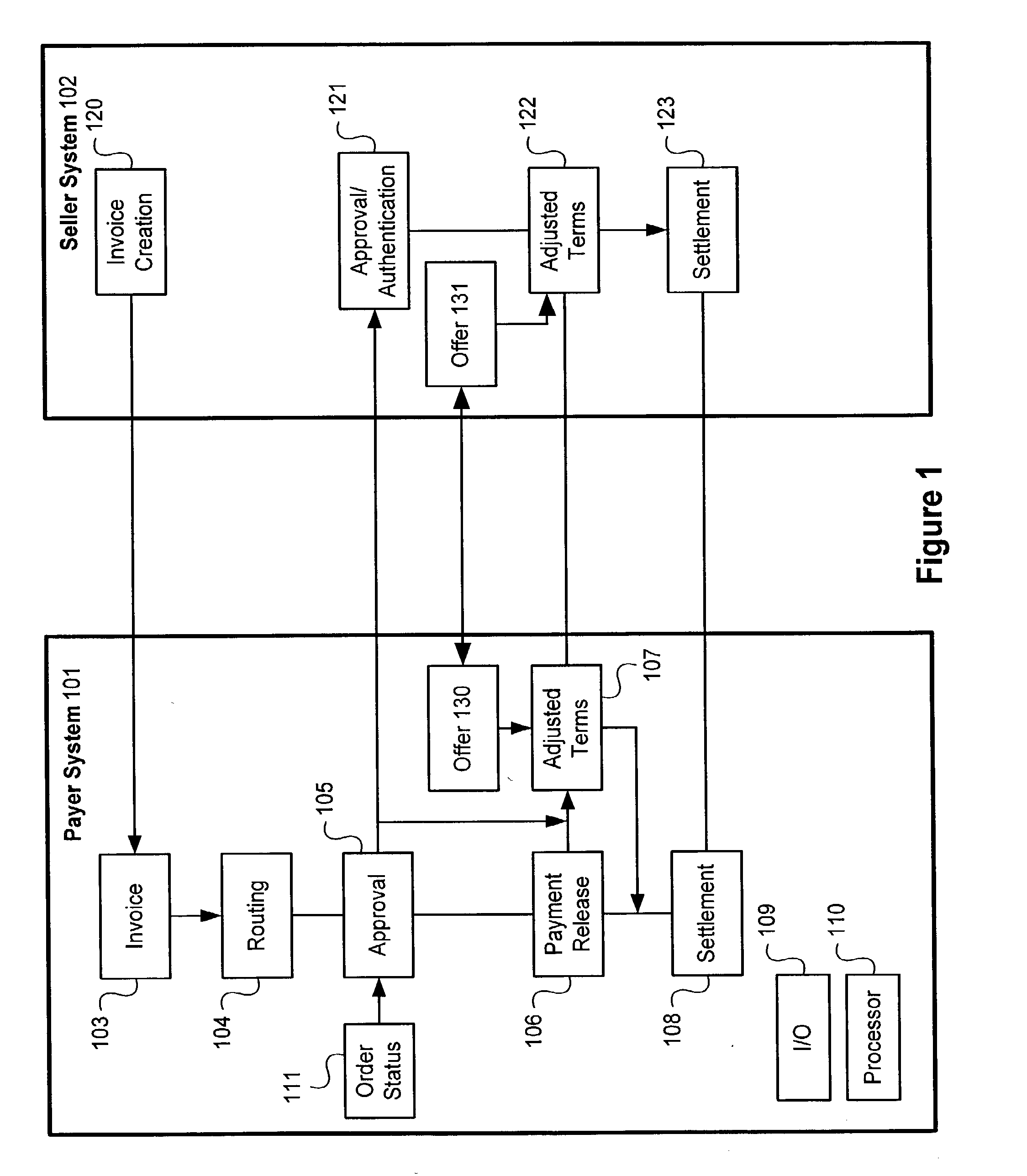

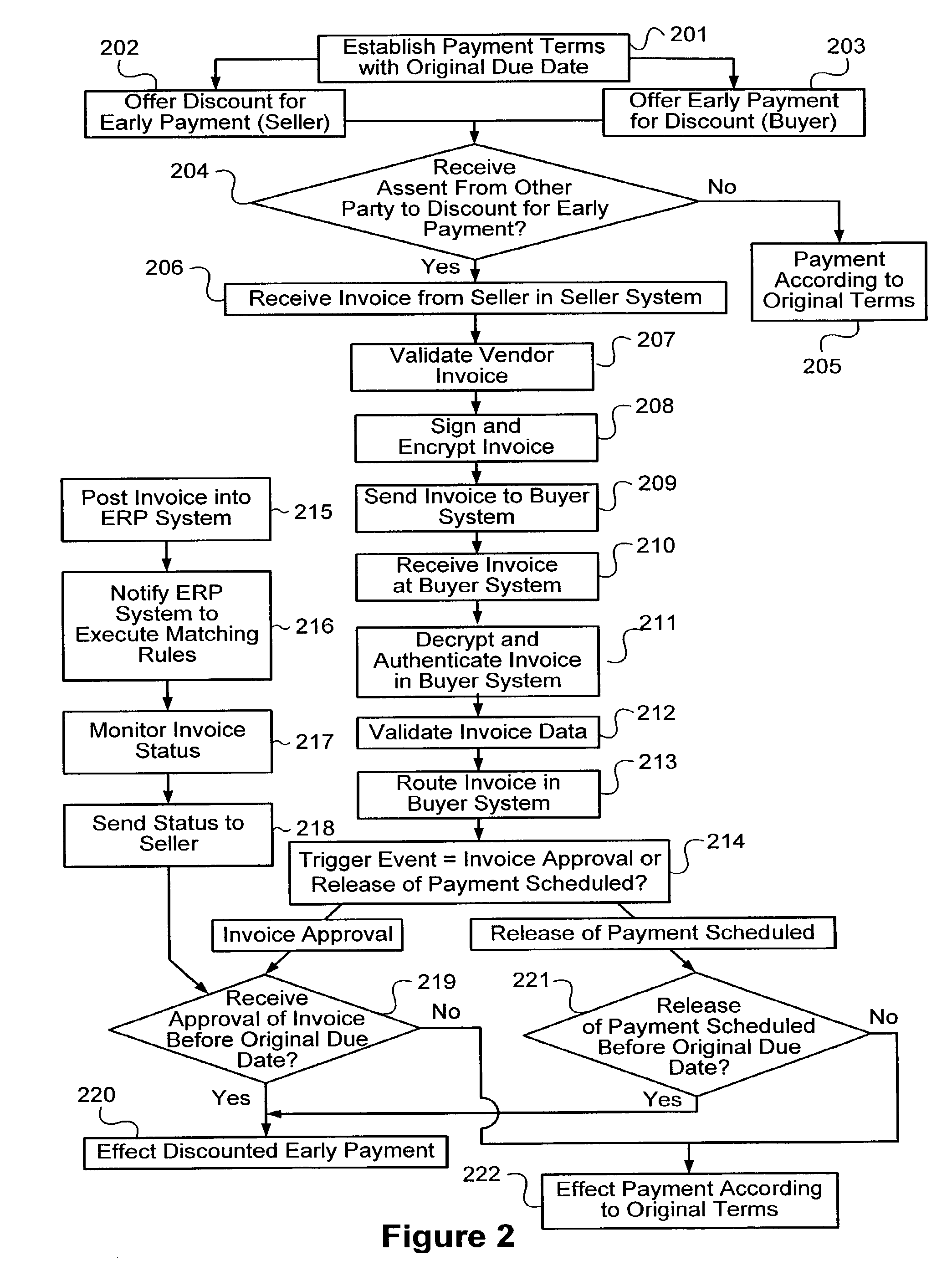

System and method for varying electronic settlements between buyers and suppliers with dynamic discount terms

A method of making payment. A request is received to effect payment between a buyer and a seller for a transaction having established terms. The terms include a payment amount and a settlement date. Messages are exchanged between the buyer and the seller that include an offer and acceptance of new terms for payment at other than the established terms. The new terms include an adjusted amount of payment to be made at a particular time after an event associated with the transaction. An electronic notification that the event has occurred is received, and the after the notification, payment between the buyer and seller is effected under the new terms. In one implementation, a digital signature indicating acceptance of the new terms is received. Another embodiment of the invention is directed to a method of effecting payment that includes receiving requests to effect a set of transactions with a set of entities. Requests for offers of terms different than the established terms are sent to the entities, and the different terms are to apply to payment made at a particular time after the event. Offers are received in response to the requests, and a set of offers among the offers is selected based on a set of one or more criteria. Requests for offers and selection of the offers may be made based on a goal seeking process. Another embodiment of the invention is directed to a method of making payment involving a buyer, seller and a third party, such as a financial institution. A system for making payment is also described.

Owner:JPMORGAN CHASE BANK NA

System and Method for Varying Electronic Settlements Between Buyers and Suppliers with Dynamic Discount Terms

A method of making payment. A request is received to effect payment between a buyer and a seller for a transaction having established terms. The terms include a payment amount and a settlement date. Messages are exchanged between the buyer and the seller that include an offer and acceptance of new terms for payment other than the established terms. The new terms include an adjusted amount of payment to be made at a particular time after an event associated with the transaction. An electronic notification that the event has occurred is received, and after the notification, payment between the buyer and seller is effected under the new terms. In one implementation, a digital signature indicating acceptance of the new terms is received. Another embodiment of the invention is directed to a method of effecting payment that includes receiving requests to effect a set of transactions with a set of entities. Requests for offers of terms different than the established terms are sent to the entities, and the different terms are to apply to payment made at a particular time after the event. Offers are received in response to the requests, and a set of offers among the offers is selected based on a set of one or more criteria. Requests for offers and selection of the offers may be made based on a goal seeking process. Another embodiment of the invention is directed to a method of making payment involving a buyer, seller and a third party, such as a financial institution. A system for making payment is also described.

Owner:JPMORGAN CHASE BANK NA

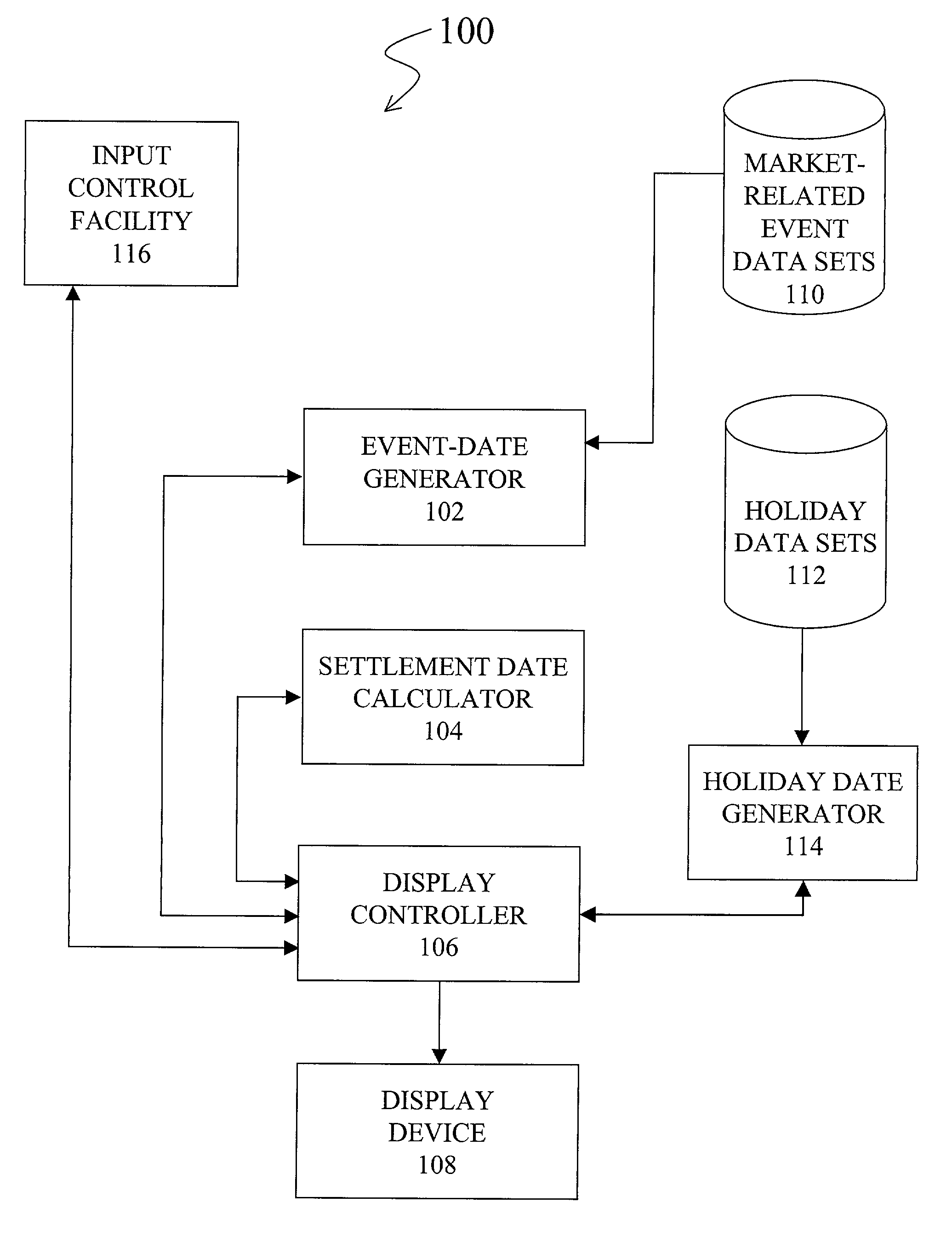

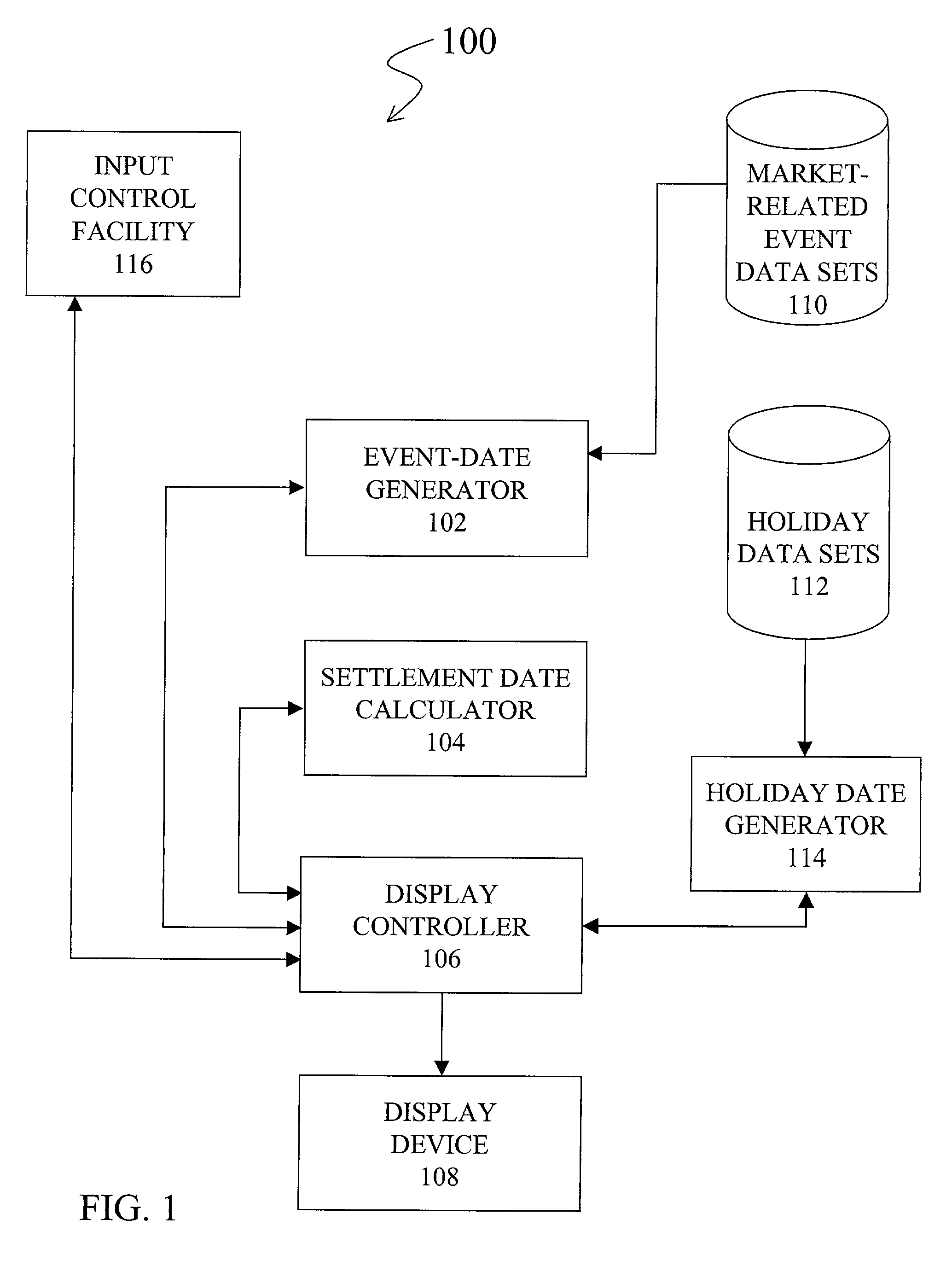

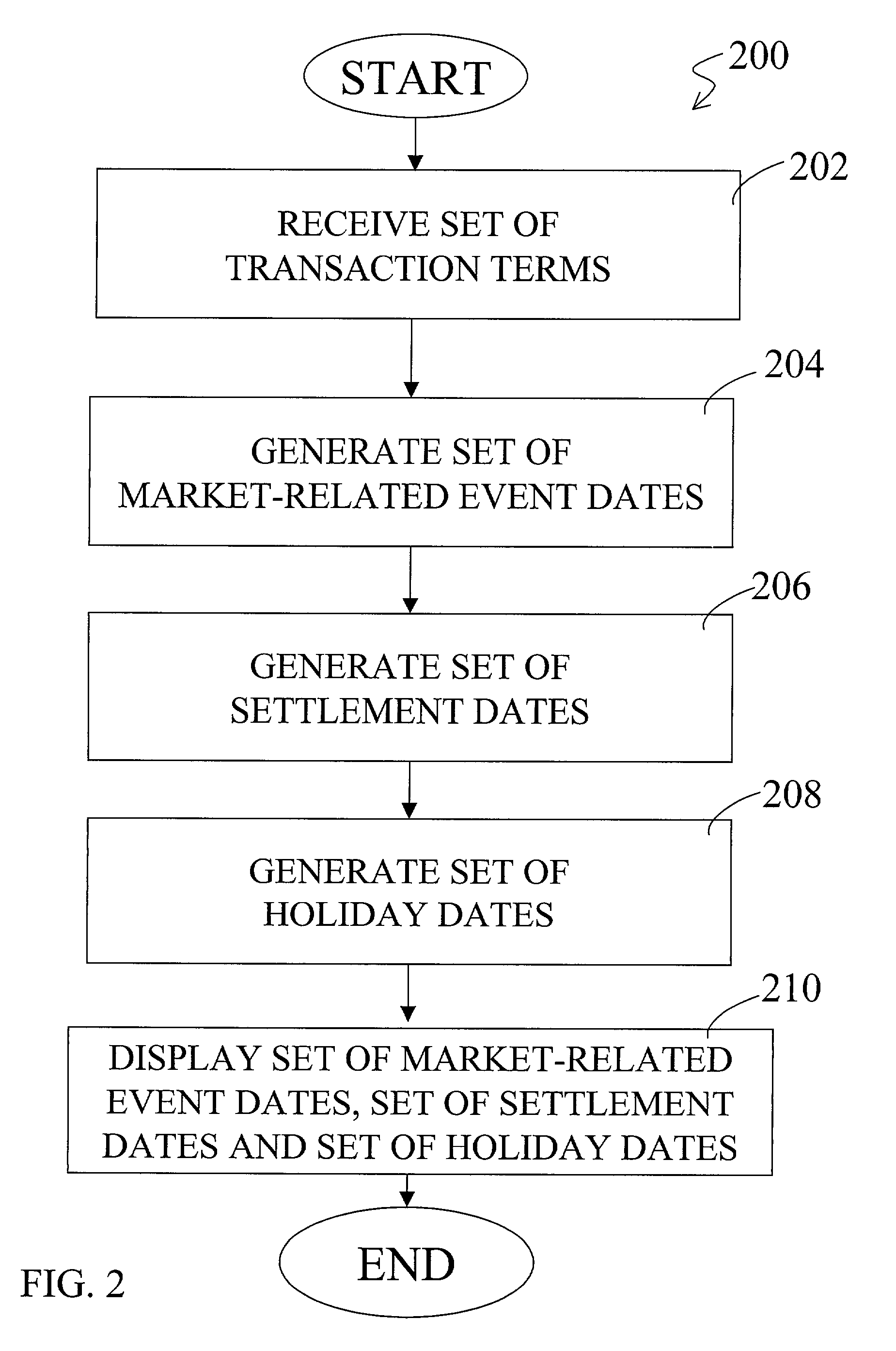

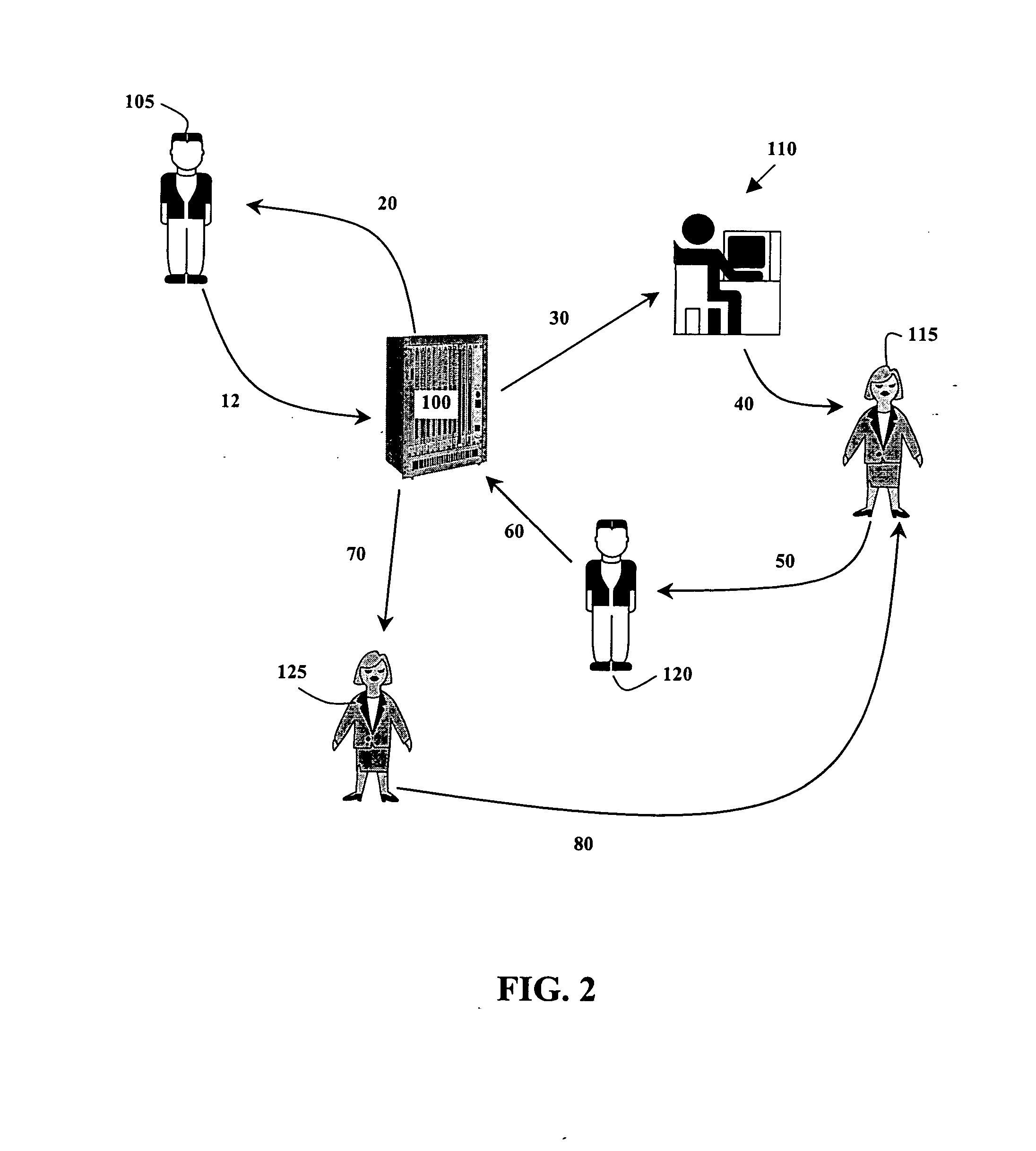

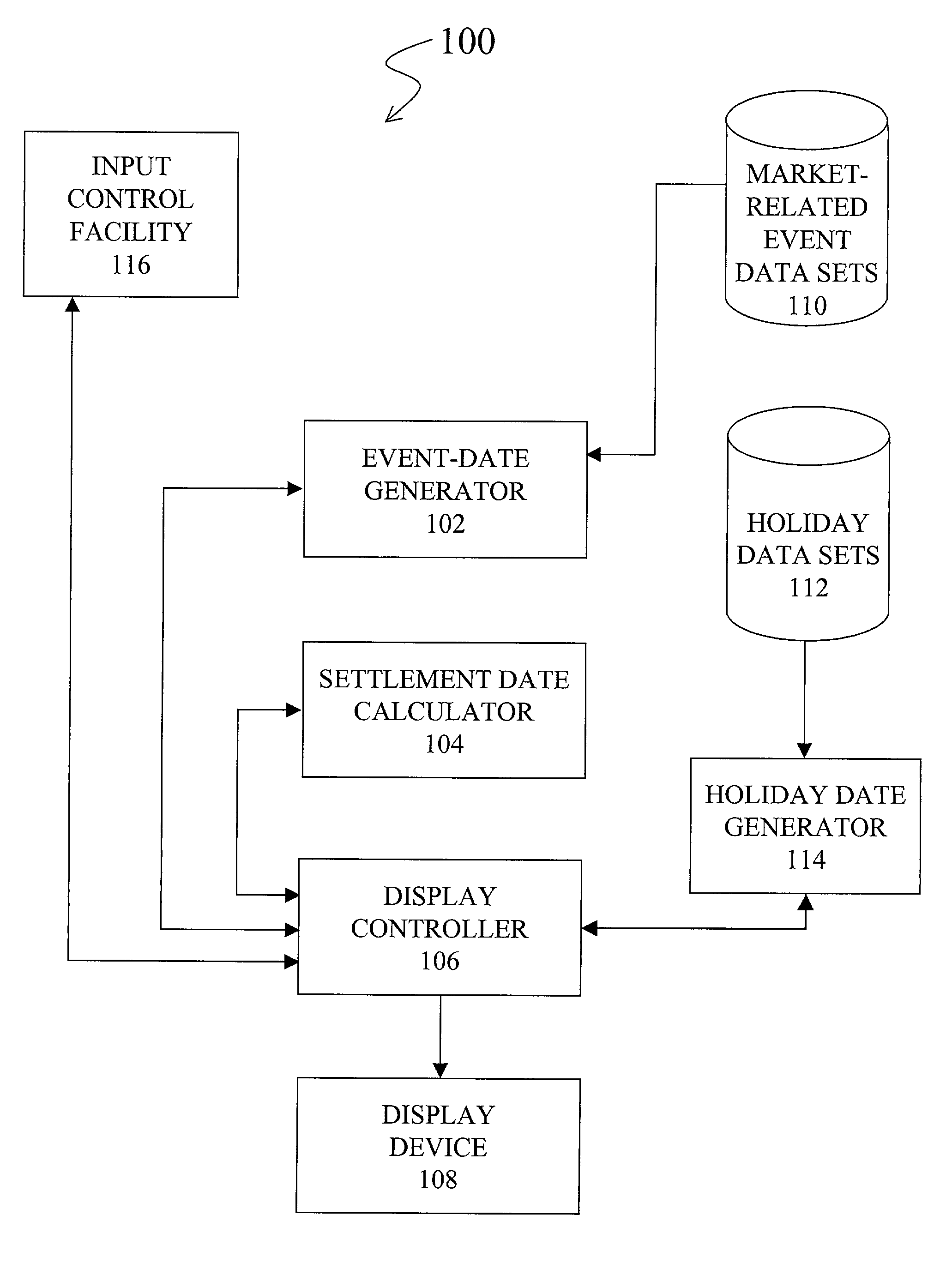

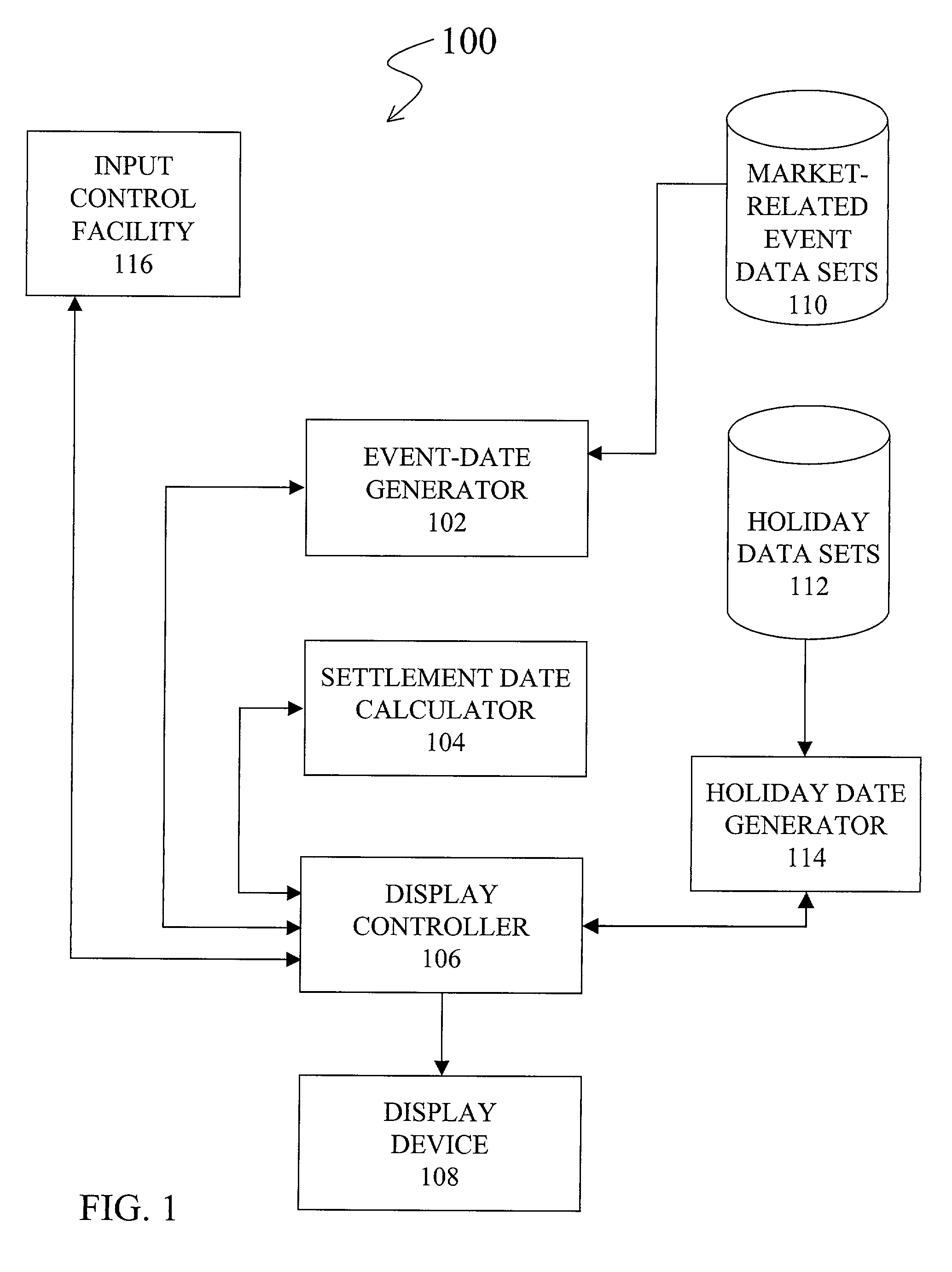

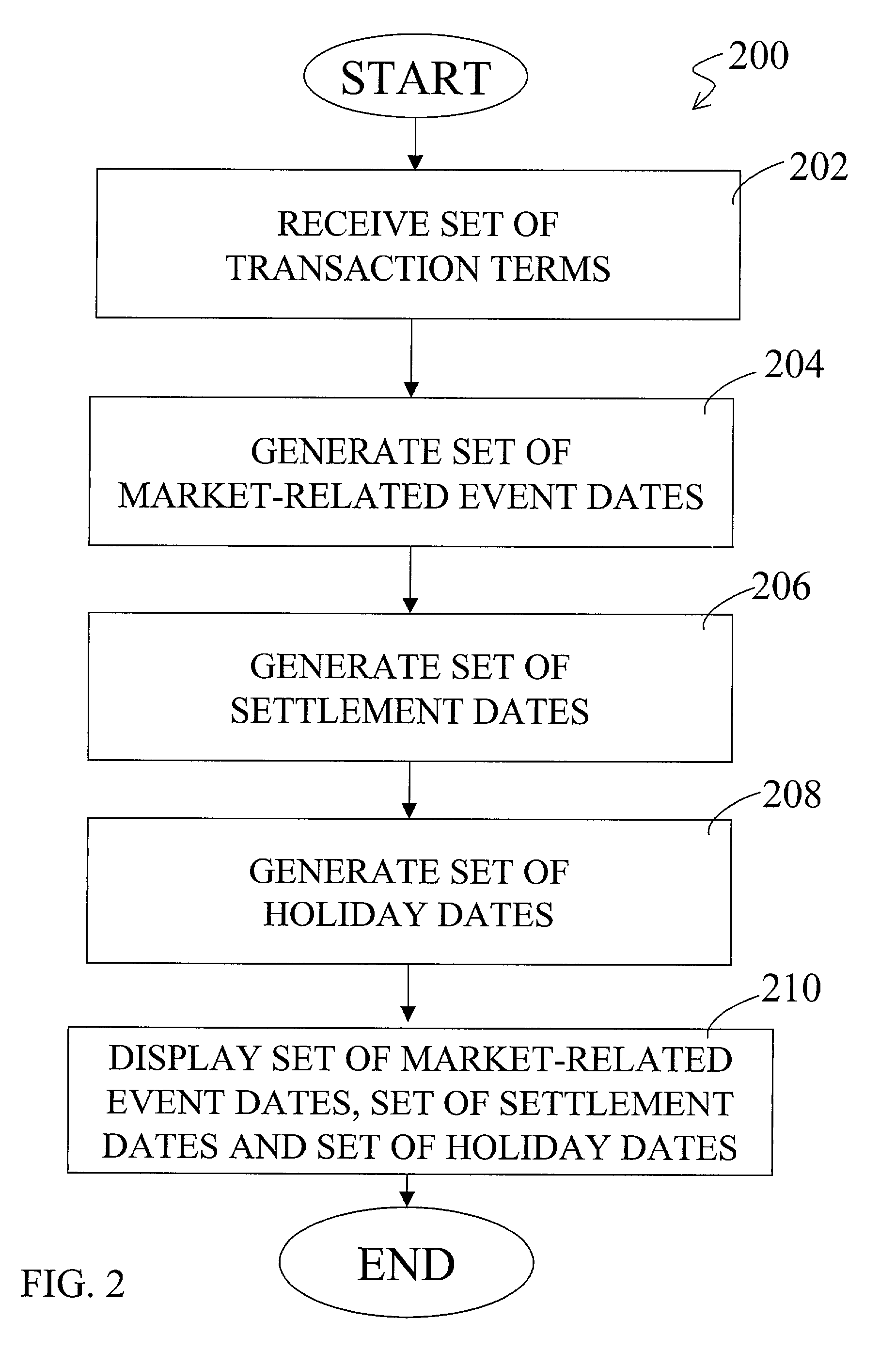

Electronic market calendar

An electronic market calendar that identifies settlement dates, holidays, market-related events, and provides links to news, information and research materials, pertaining to certain transaction terms, currencies or territories. The invention displays or provides a market calendar in which each one of a plurality of calendar dates that corresponds to a settlement date, a market-related event date or a holiday is displayed in a visibly distinct manner from the rest of the calendar dates. The set of market-related events may include, for example, events such as national elections, publications of economic forecasts, releases of economic reports, monetary policy announcements, trade announcements, interest rate announcements, press releases, governmental hearings, federal open market committee meetings, financial summit meetings, or any other events related to the market in which the electronic market calendar is applied.

Owner:REFINITIV US ORG LLC

System and method for automated release tracking

A real estate transaction and release tracking system ensures deeds of trust, liens and other encumbrances are released in a timely manner after a specified (or statutory) period of time following settlement of a real estate transaction. Based on information provided by an agent, such as an escrow agent or a settlement agent, the system creates a unique electronic record for each real estate transaction entered by the agent. The system tracks lien status information, either automatically from other computers or via manual input from searchers, and uses this status information to track each real estate transaction. The system monitors the records and indicates when a lien holder has failed to release their lien after a statutory time period that begins after the passing of the settlement date. When the statutory time period has passed, the system can generate a number of forms, including a demand letter as controlled optionally by the system or the user. The demand letter can be sent to the lien holder demanding them to release the lien. If the lien is not thereafter released, further legal documents can be generated and sent to a law firm or enforcement agent for legal action to be taken against the delinquent lien holder.

Owner:MORRIS DANIEL R

Electronic market calendar for displaying standard settlement dates, future market-related events and holidays pertaining to a financial transaction

An electronic market calendar that identifies settlement dates, holidays, market-related events, and provides links to news, information and research materials, pertaining to certain transaction terms, currencies or territories. The invention displays or provides a market calendar in which each one of a plurality of calendar dates that corresponds to a settlement date, a market-related event date or a holiday is displayed in a visibly distinct manner from the rest of the calendar dates. The set of market-related events may include, for example, events such as national elections, publications of economic forecasts, releases of economic reports, monetary policy announcements, trade announcements, interest rate announcements, press releases, governmental hearings, federal open market committee meetings, financial summit meetings, or any other events related to the market in which the electronic market calendar is applied.

Owner:REFINITIV US ORG LLC

System and method for automated release tracking

A real estate transaction and release tracking system ensures deeds of trust, liens and other encumbrances are released in a timely manner after a specified (or statutory) period of time following settlement of a real estate transaction. Based on information provided by an agent, such as an escrow agent or a settlement agent, the system creates a unique electronic record for each real estate transaction entered by the agent. The system tracks lien status information, either automatically from other computers or via manual input from searchers, and uses this status information to track each real estate transaction. The system monitors the records and indicates when a lien holder has failed to release their lien after a statutory time period that begins after the passing of the settlement date. When the statutory time period has passed, the system can generate a number of forms, including a demand letter as controlled optionally by the system or the user. The demand letter can be sent to the lien holder demanding them to release the lien. If the lien is not thereafter released, further legal documents can be generated and sent to a law firm or enforcement agent for legal action to be taken against the delinquent lien holder.

Owner:MORRIS DANIEL R

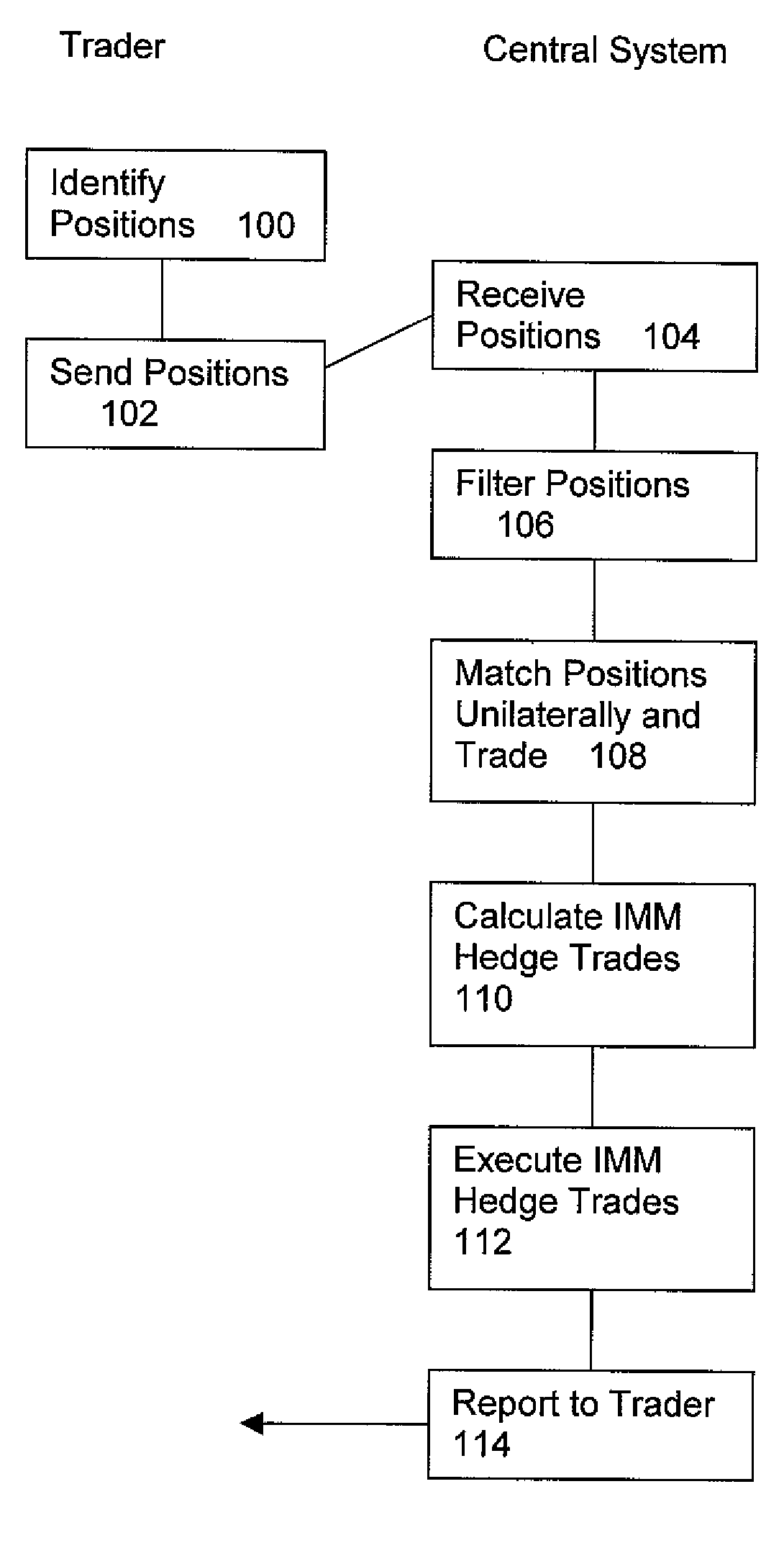

Method and System for Offset Matching

The trading of interest rate swaps or other interest rate derivatives gives rise to mismatch exposure. This can be offset by a series of FRA trades. Rather than conducting a series of exposure neutral trades, FRAs can be bought or sold for the entire amount of a trader's reset exposure. To hedge the offset trades, a series of IMM FRA trades are conducted. The relative size of the IMM contracts will be determined by the distance in time from the IMM quarterly contract settlement date. A system is disclosed for performing offset trades and IMM hedges. The embodiments allow for non-neutral trading and subsequent heging brings trading back to a neutral position.

Owner:INTERCAPITAL MANAGEMENT SERVICES NO 2 LTD +1

System and method for automated release tracking

A real estate transaction and release tracking system ensures deeds of trust, liens and other encumbrances are released in a timely manner after a specified (or statutory) period of time following settlement of a real estate transaction. Based on information provided by an agent, such as an escrow agent or a settlement agent, the system creates a unique electronic record for each real estate transaction entered by the agent. The system tracks lien status information, either automatically from other computers or via manual input from searchers, and uses this status information to track each real estate transaction. The system monitors the records and indicates when a lien holder has failed to release their lien after a statutory time period that begins after the passing of the settlement date. When the statutory time period has passed, the system can generate a number of forms, including a demand letter as controlled optionally by the system or the user. The demand letter can be sent to the lien holder demanding them to release the lien. If the lien is not thereafter released, further legal documents can be generated and sent to a law firm or enforcement agent for legal action to be taken against the delinquent lien holder.

Owner:MORRIS DANIEL R

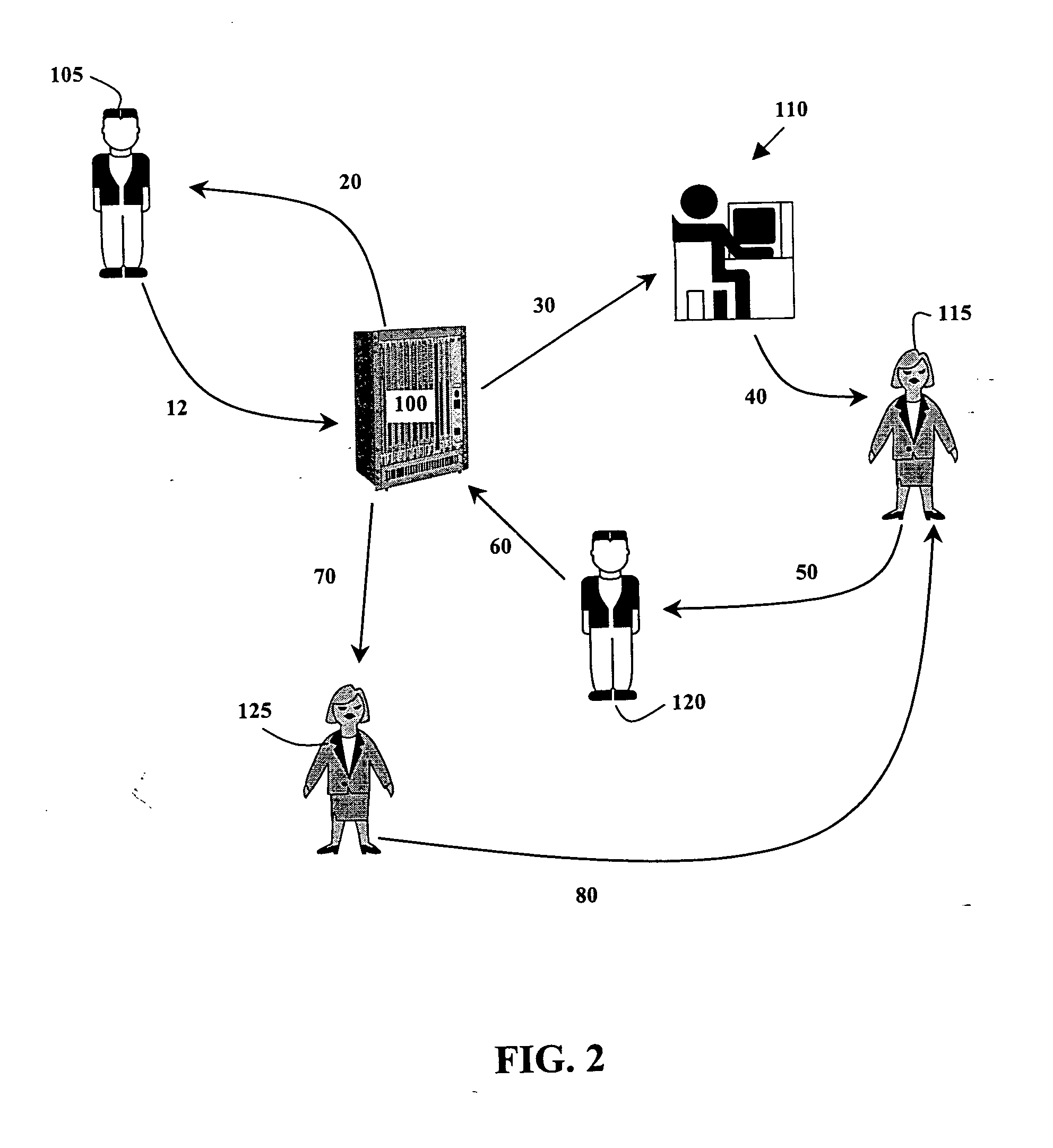

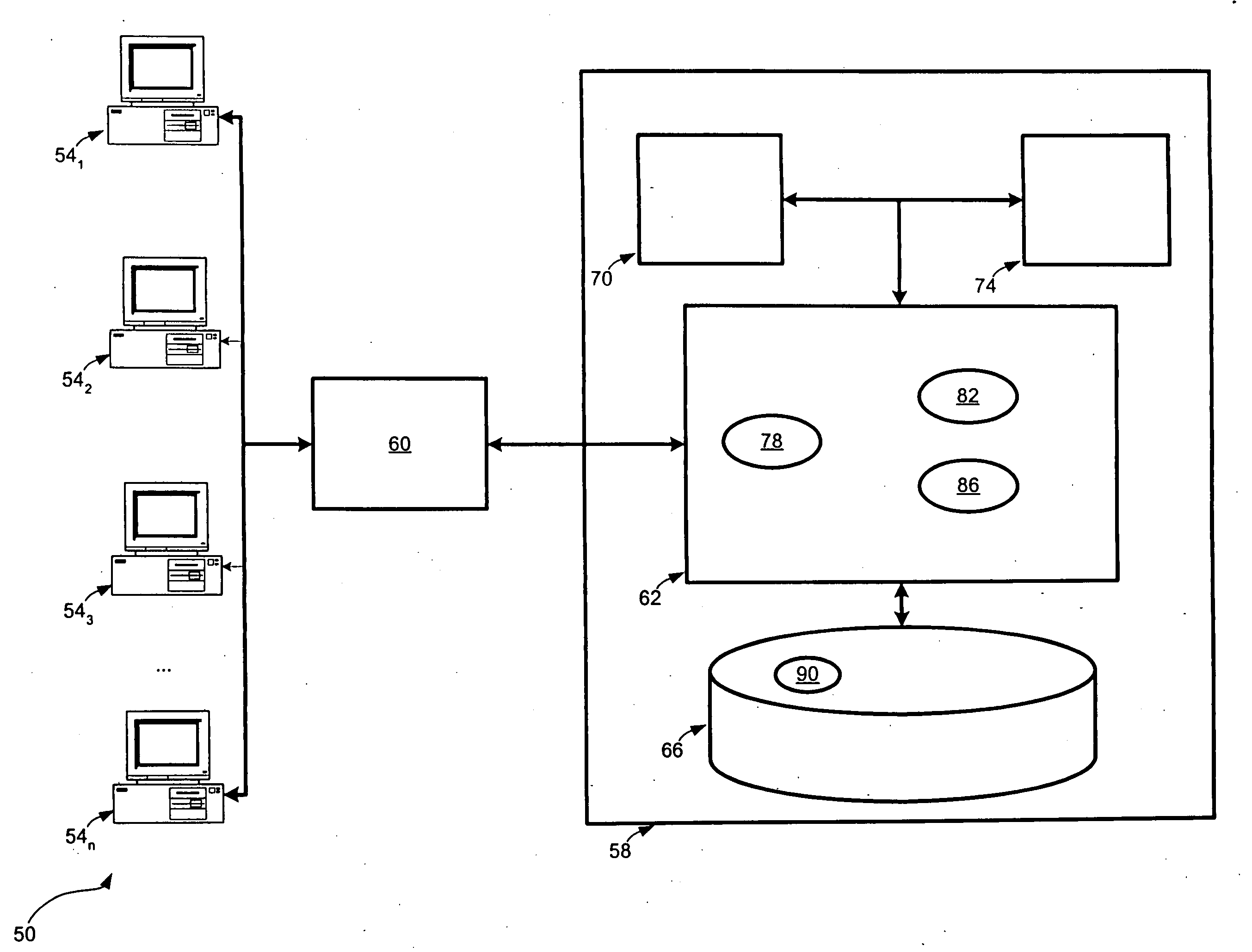

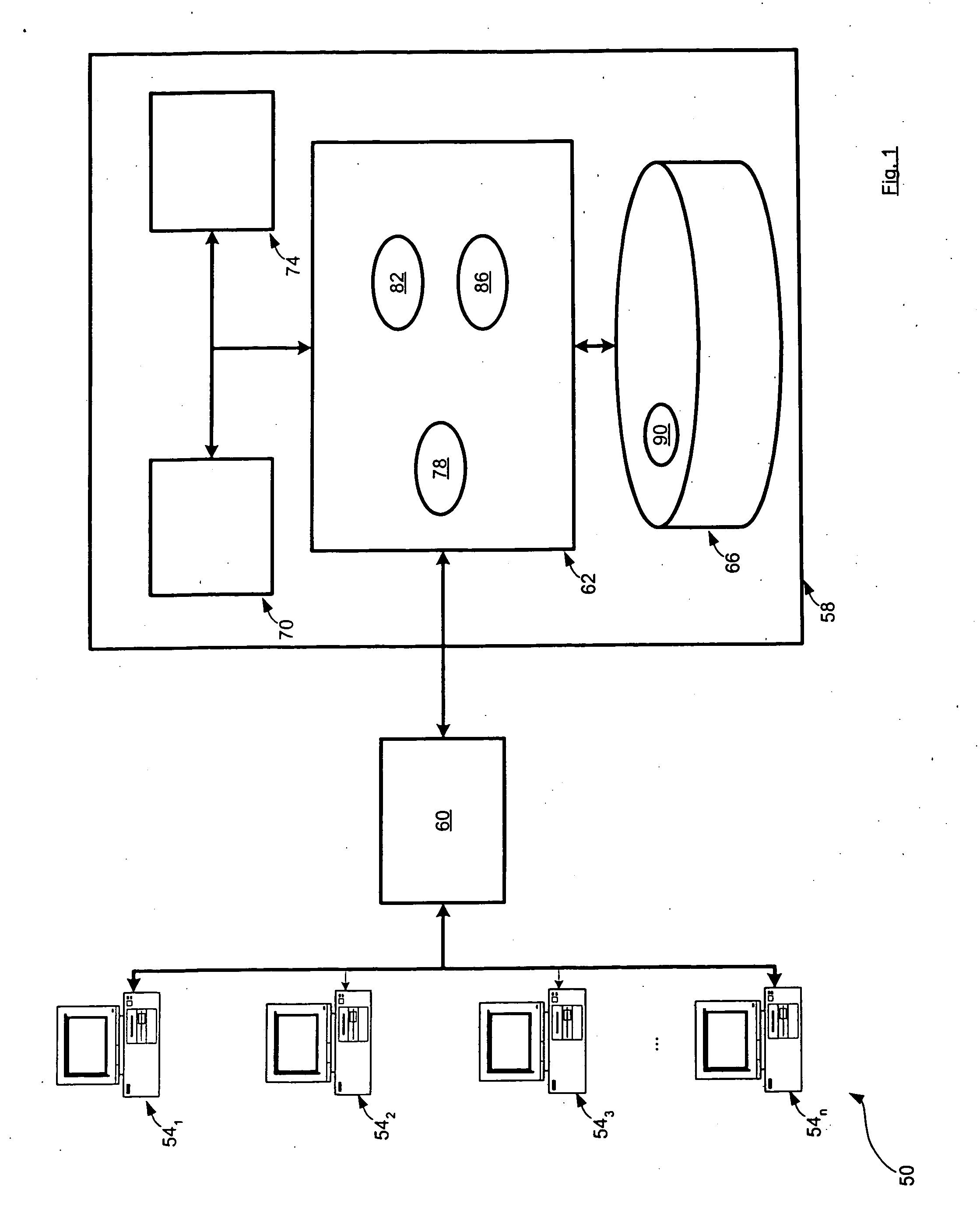

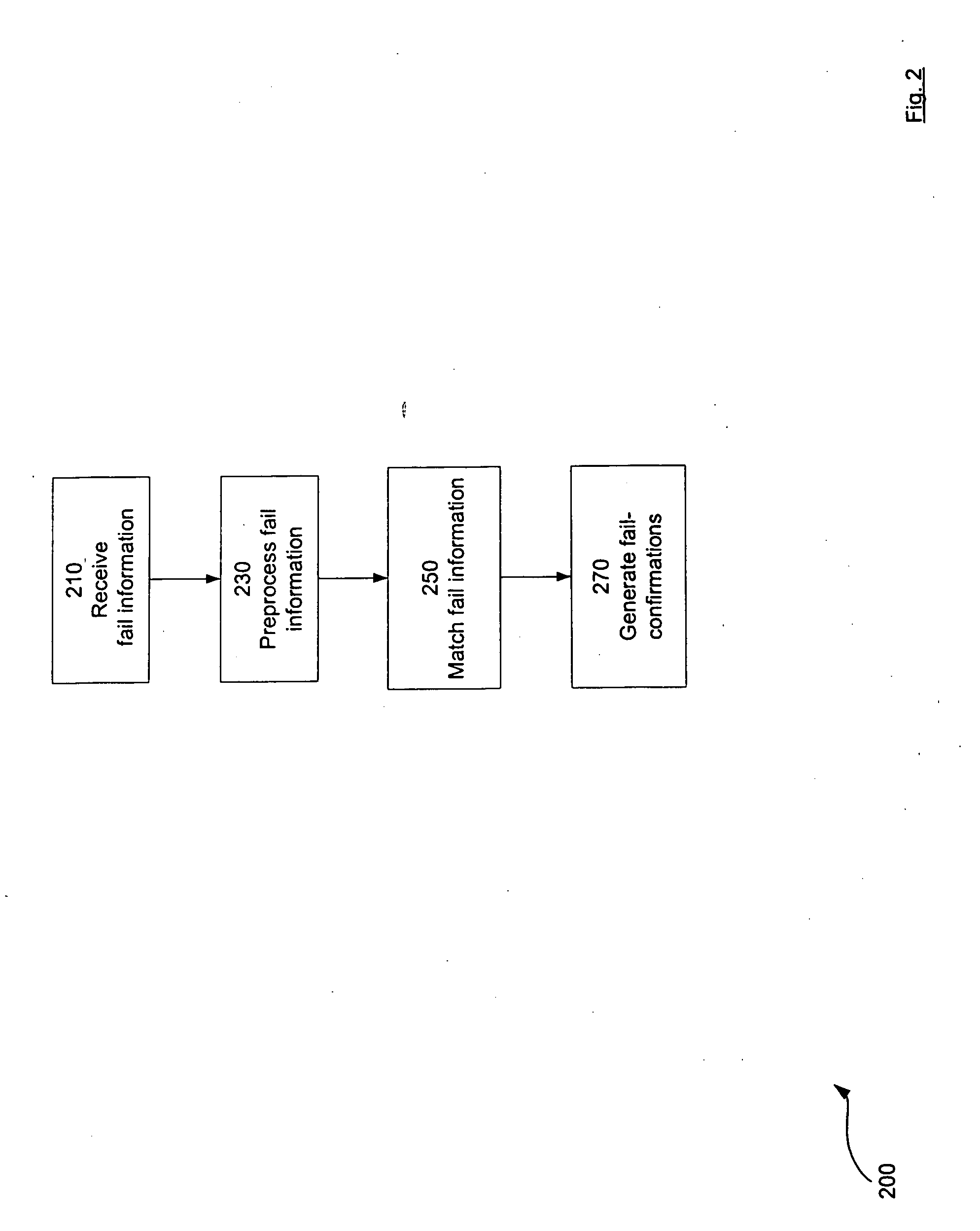

Computer-based system and method for confirming failed trades of securities

The present invention provides a novel system and method for confirming failed trades. In securities trading, and particularly mortgage backed securities trading, there can be a desire to provide market liquidity by allowing trading of securities by parties, even where party does not actually have the securities necessary to satisfy the trade, on the view that the party will acquire the necessary securities to satisfy the trade in advances of the settlement date. However, market instability can result from actual failures to satisfy the trade. The present system and method provide a means for reducing such instability by confirming such failed trades.

Owner:CHAPDELAINE MBS

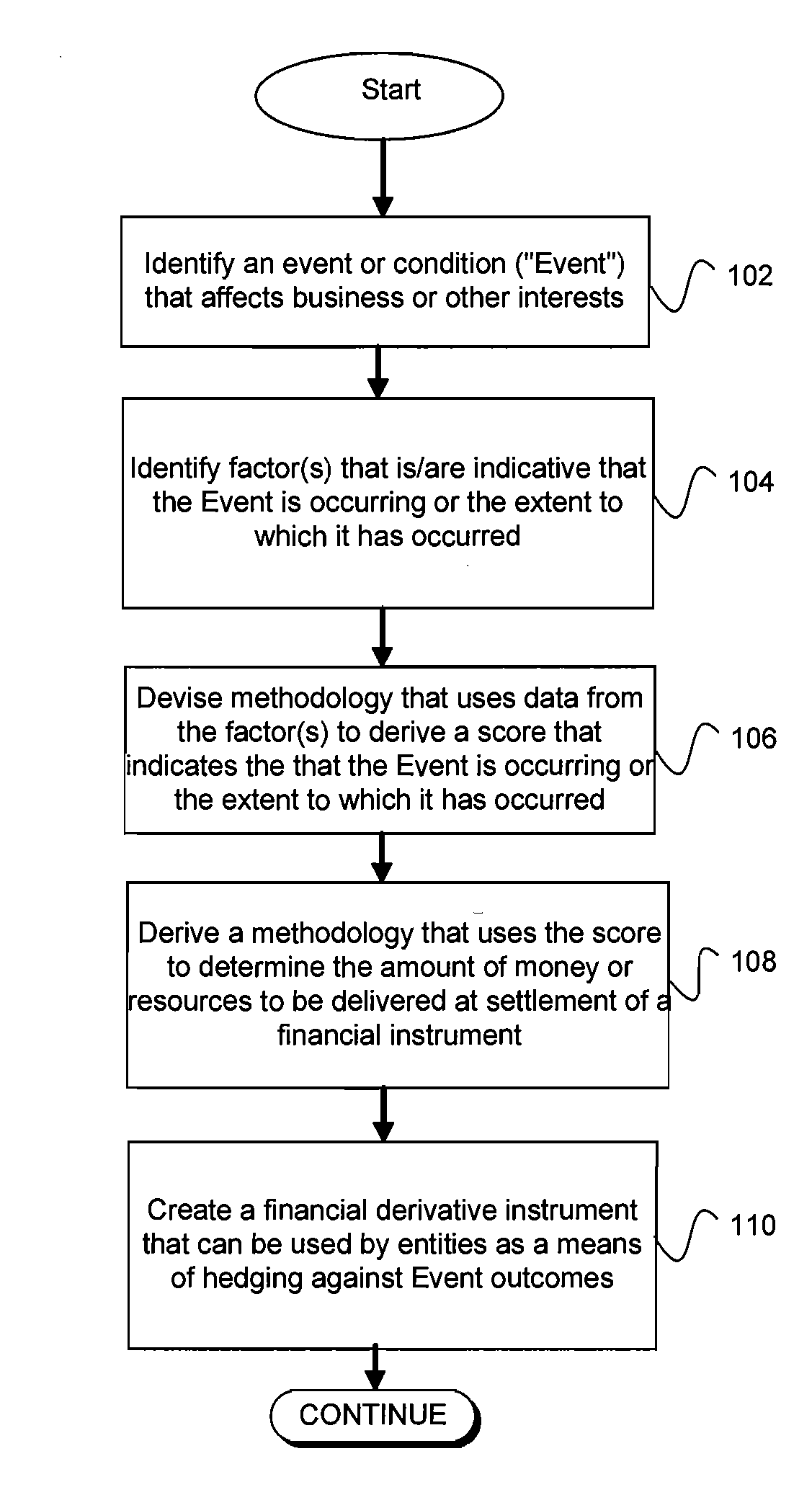

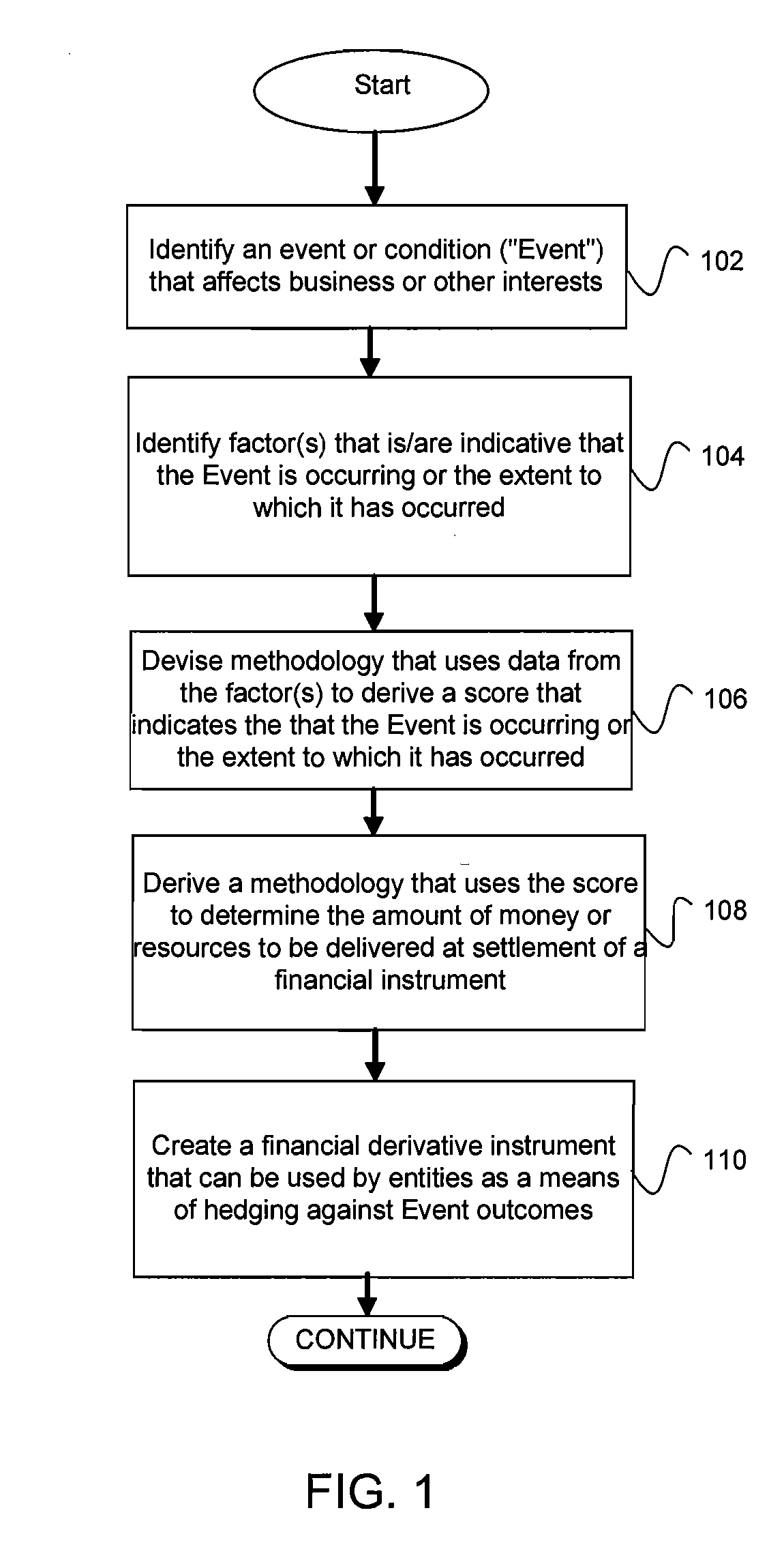

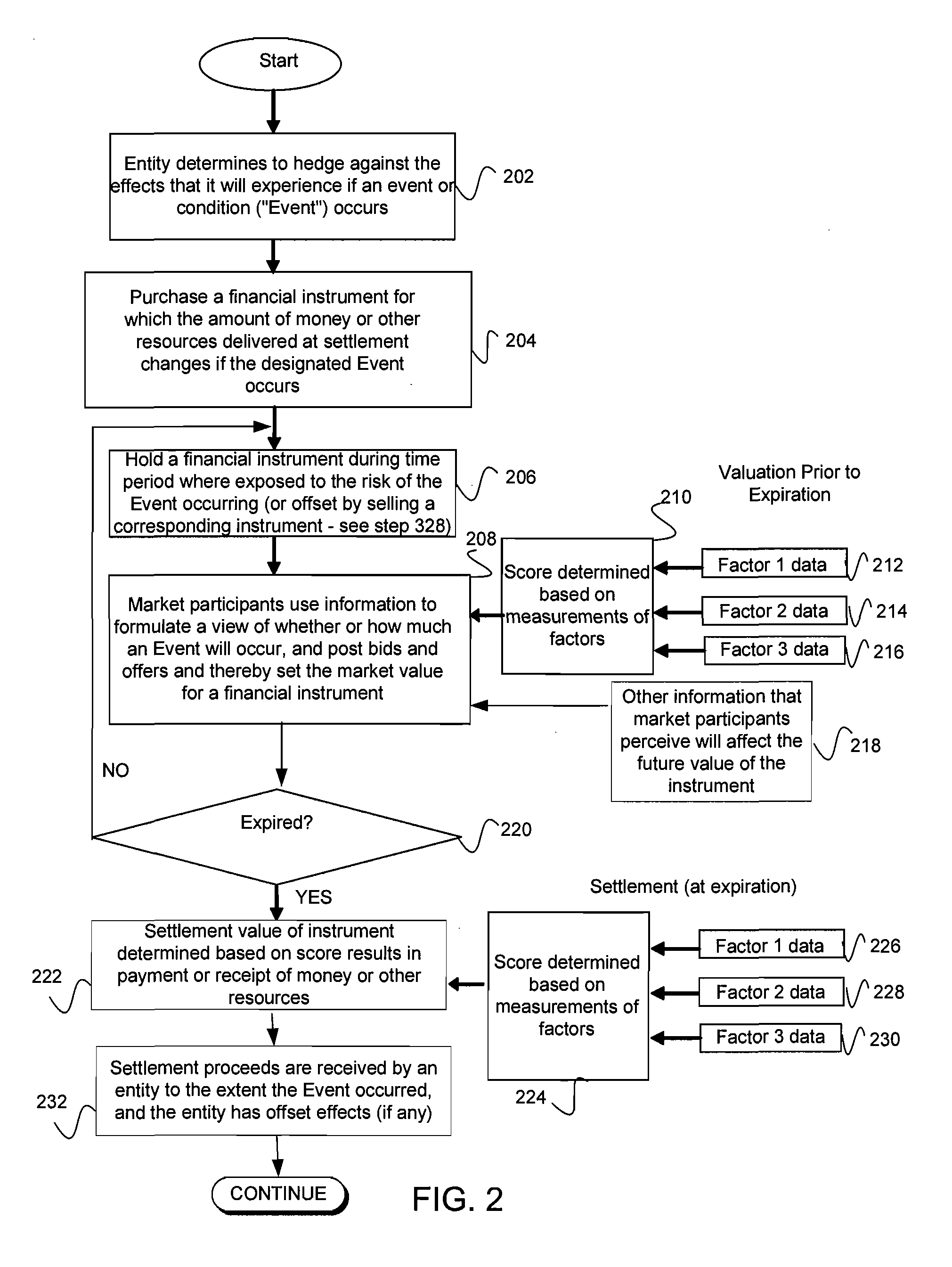

System, method and media for trading of event-linked derivative instruments

A derivative financial instrument is created which facilitates the reallocation of a risk caused by the occurrence of an event or condition. For example, a system, method, and media are directed to allocating risks of water shortages. A computer-readable financial instrument is established based on a water availability score that is calculated from one or more types of hydrological factors, a settlement value function, and a settlement date. The financial instrument is configured to transfer, on the settlement date, a cash or physical commodity amount to a buyer or seller of the instrument as determined by the contract specification if the score is zero, or a positive or negative number or within a specified range of positive or negative values.

Owner:CHICAGO CLIMATE EXCHANGE

Method for valuing forwards futures and options on real estate

A system and method for matching buy and sell orders is provided. A daily cash index of real estate values for a local region is maintained based on real estate transactions and / or real estate transactional activity, and a trading instrument representative of an interest in real estate in the local region is created. In this regard, a cash settlement of the trading instrument is a function of the daily cash index on the date of said cash settlement. In addition, a plurality of buy orders relating to the instrument are generated; a plurality of sell orders relating to the instrument are generated; and the buy and sell orders are matched to determine a purchase and sale of the instrument.

Owner:RADAR LOGIC

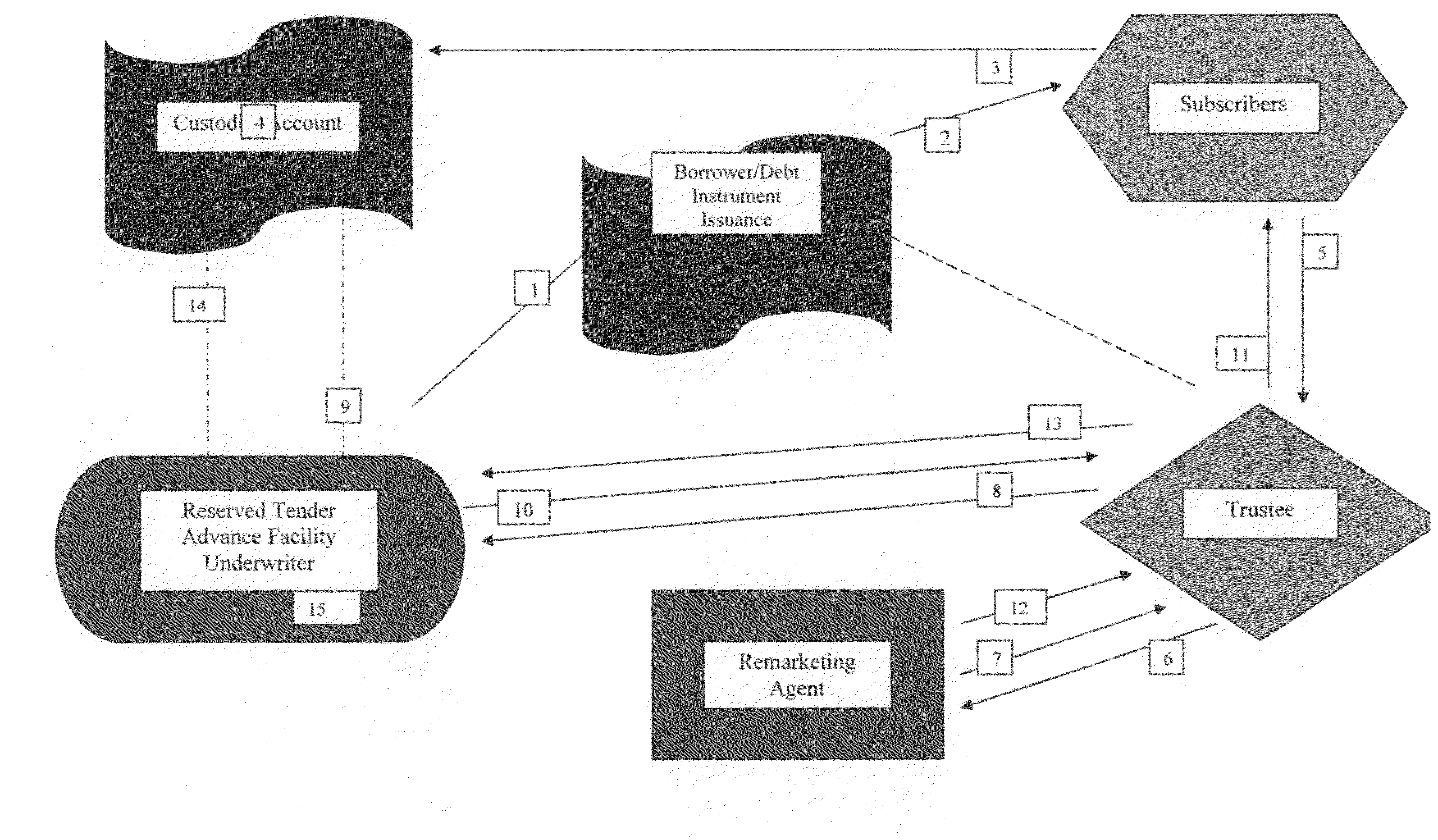

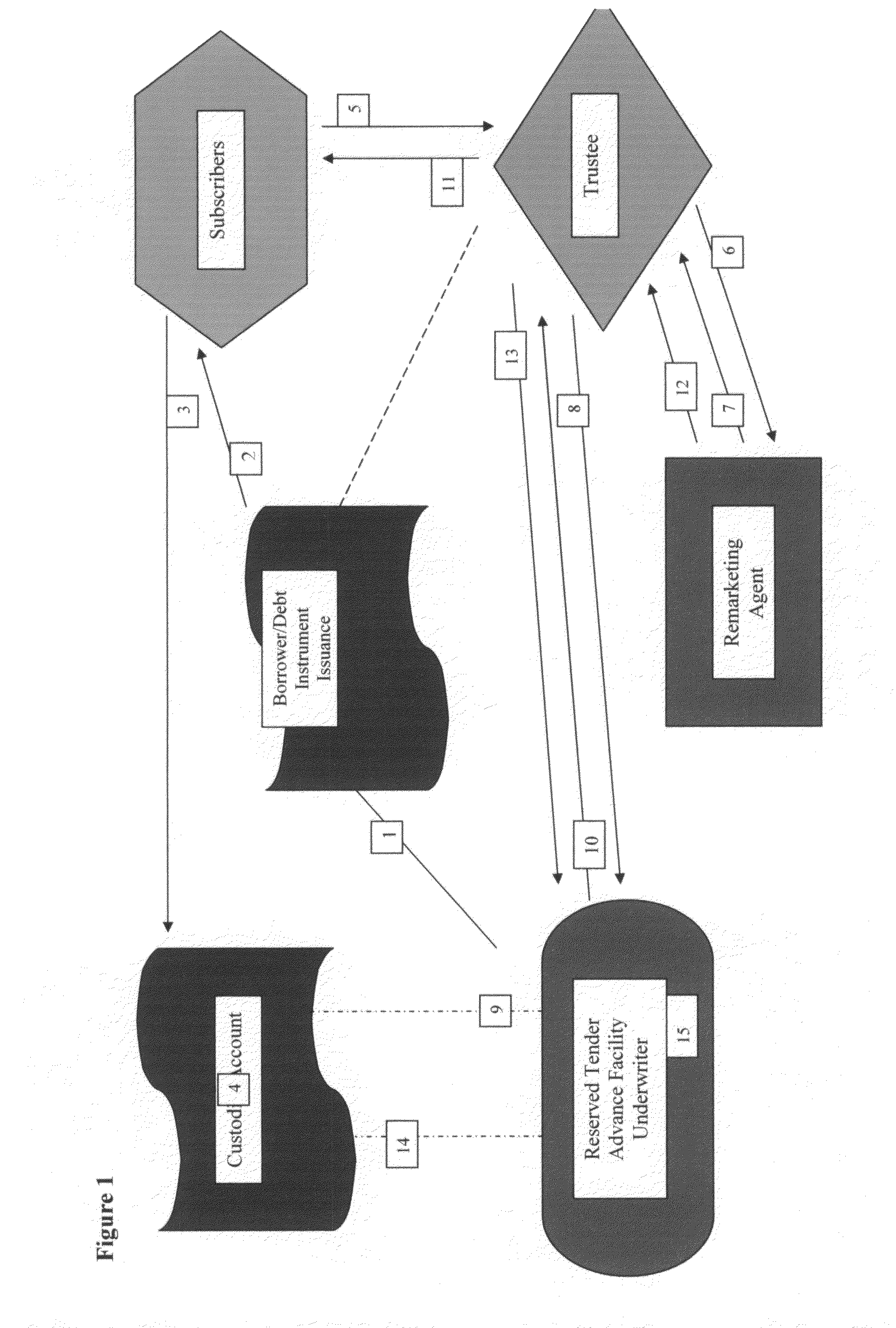

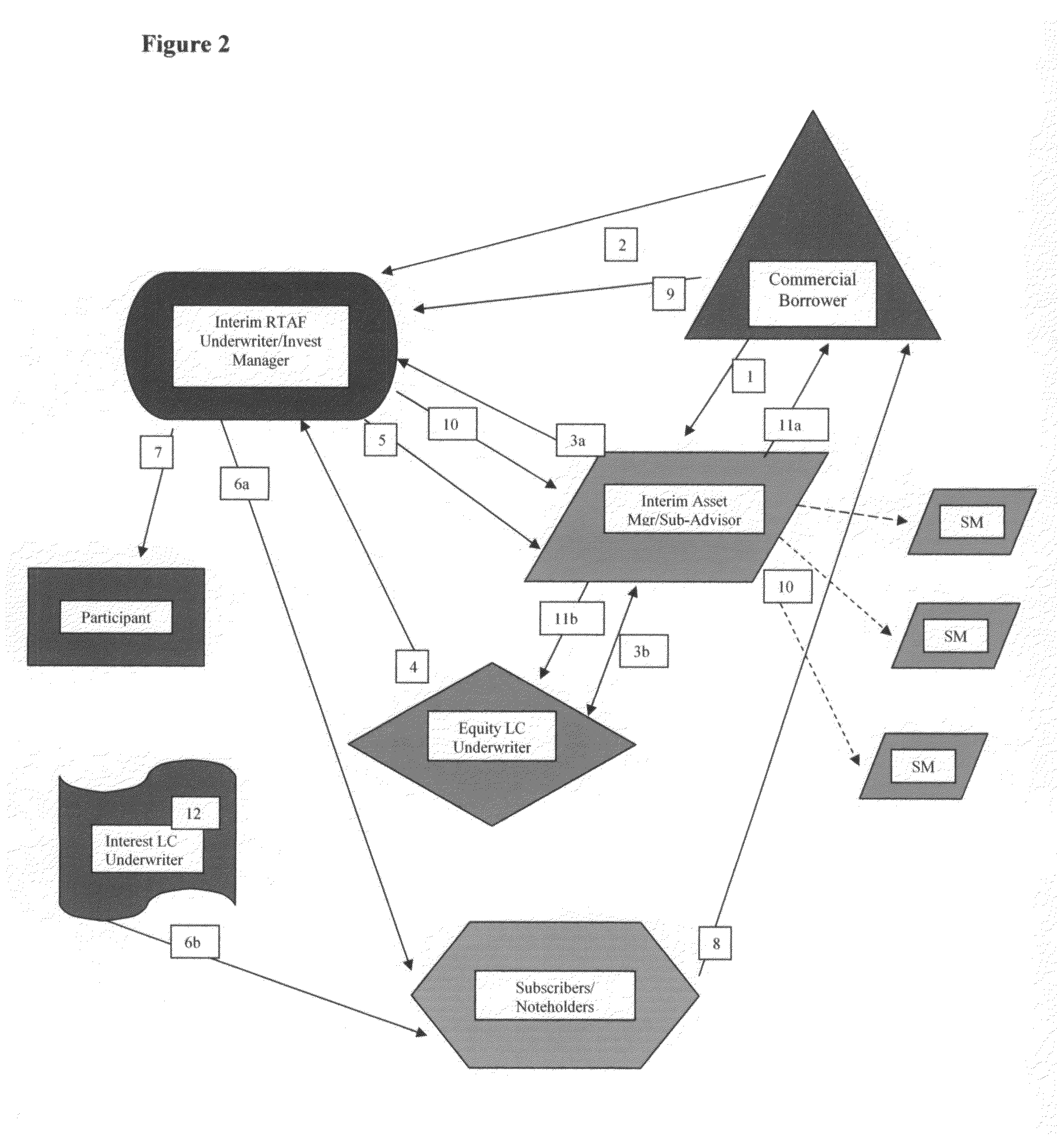

Reserved tender advance facility

A financial process in accordance with the principles of the present invention enables an amount of financing instruments to be credit enhanced. A reserved tender advance facility is established for an aggregate value minimally equal to the principal amount of debt to be undertaken. The reserved tender advance facility may be supplemented for first-loss or principal risk by the delivery of equity either in cash or in the form of an equity letter of credit. The reserved tender advance facility is maintained on standby until such time as a drawing made there under is received. Financing instruments, in reliance upon the credit-worthiness of reserved tender advance facility provider, are sold to eligible investors. Proceeds from the sale of the financing instruments are deposited in at least one account from which the proceeds will be invested in eligible investments. When a tender of the financing instruments is received, financing instruments obligation are directed for satisfaction of the tender and the financing instruments are remarketed for repurchase prior to the tender settlement date. In the event of a shortfall of remarketing proceeds, the reserved tender advance facility is drawn for the value of the shortfall.

Owner:MARIAM SYST

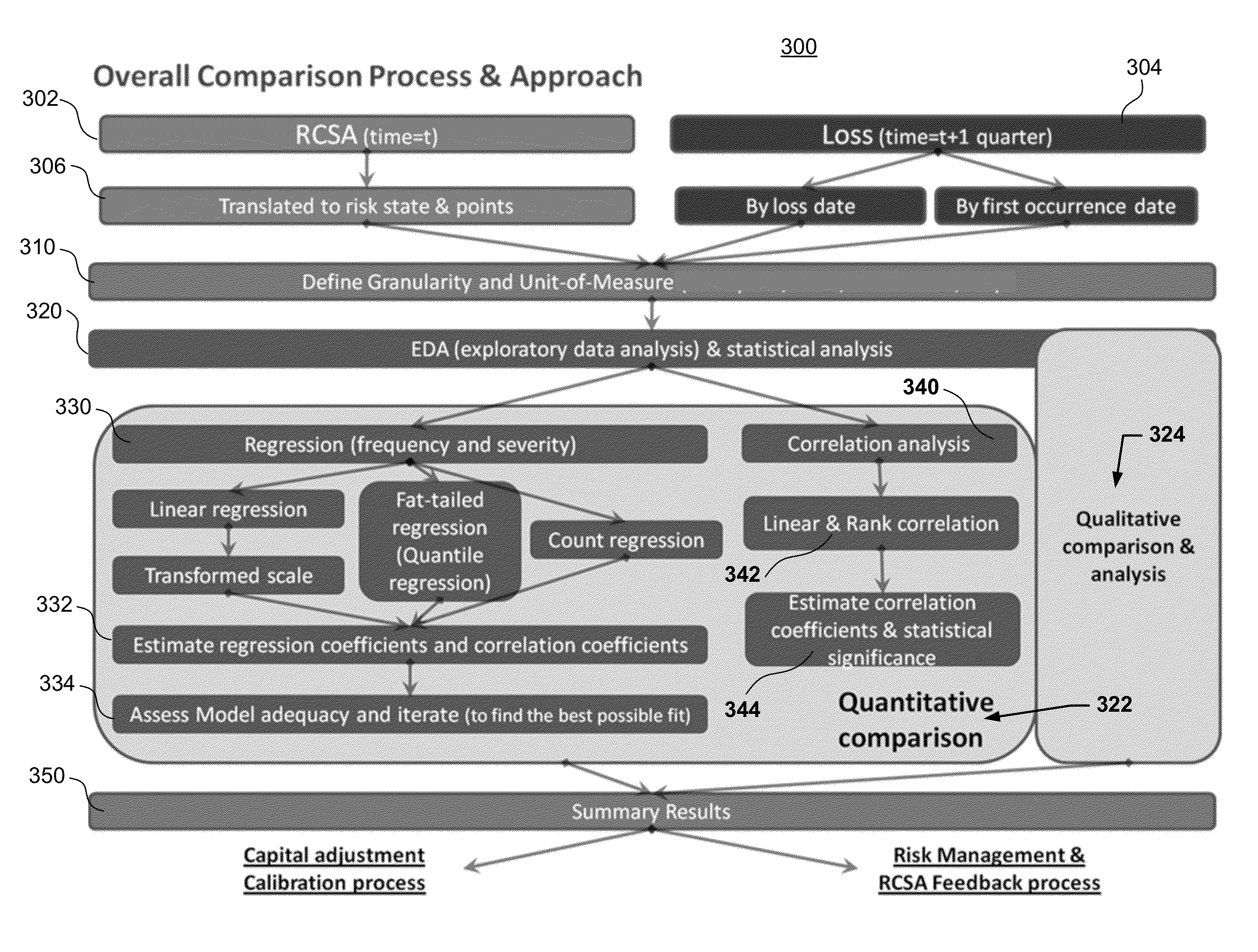

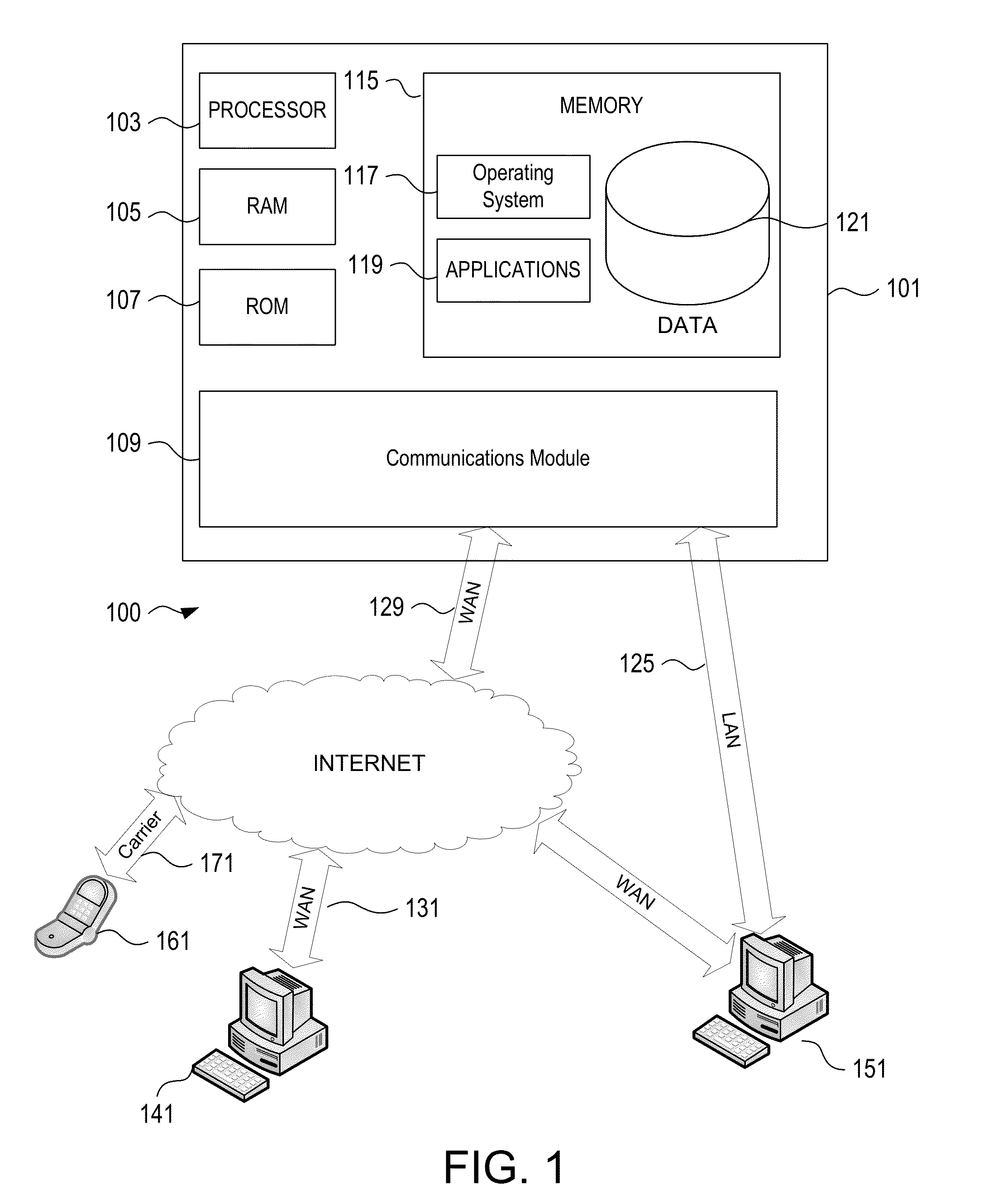

Operational Risk Back-Testing Process Using Quantitative Methods

Methods, computer-readable media, and apparatuses are disclosed for quantifying risk and control assessments. The risk includes both residual risk and direction of risk. Various aspects of the invention quantitatively compare the risk and control assessments against step-ahead losses using special regression models that are particularly applicable to this kind of data. The empirical comparison may be performed on both loss event frequency and severity in two different and separate dimensions. The empirical comparison may also be performed using losses extracted by even occurrence and event settlement dates in two separate dates.

Owner:BANK OF AMERICA CORP

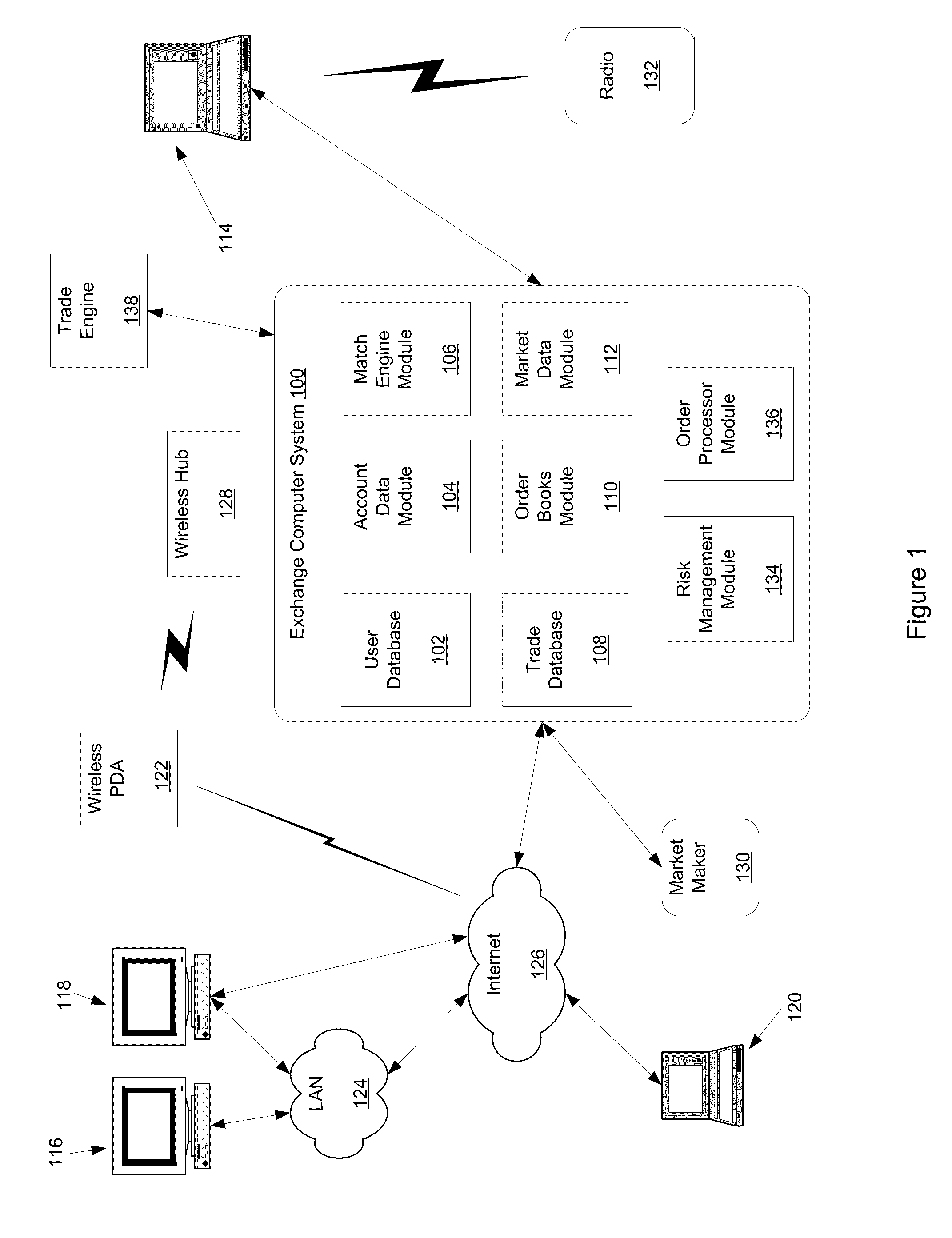

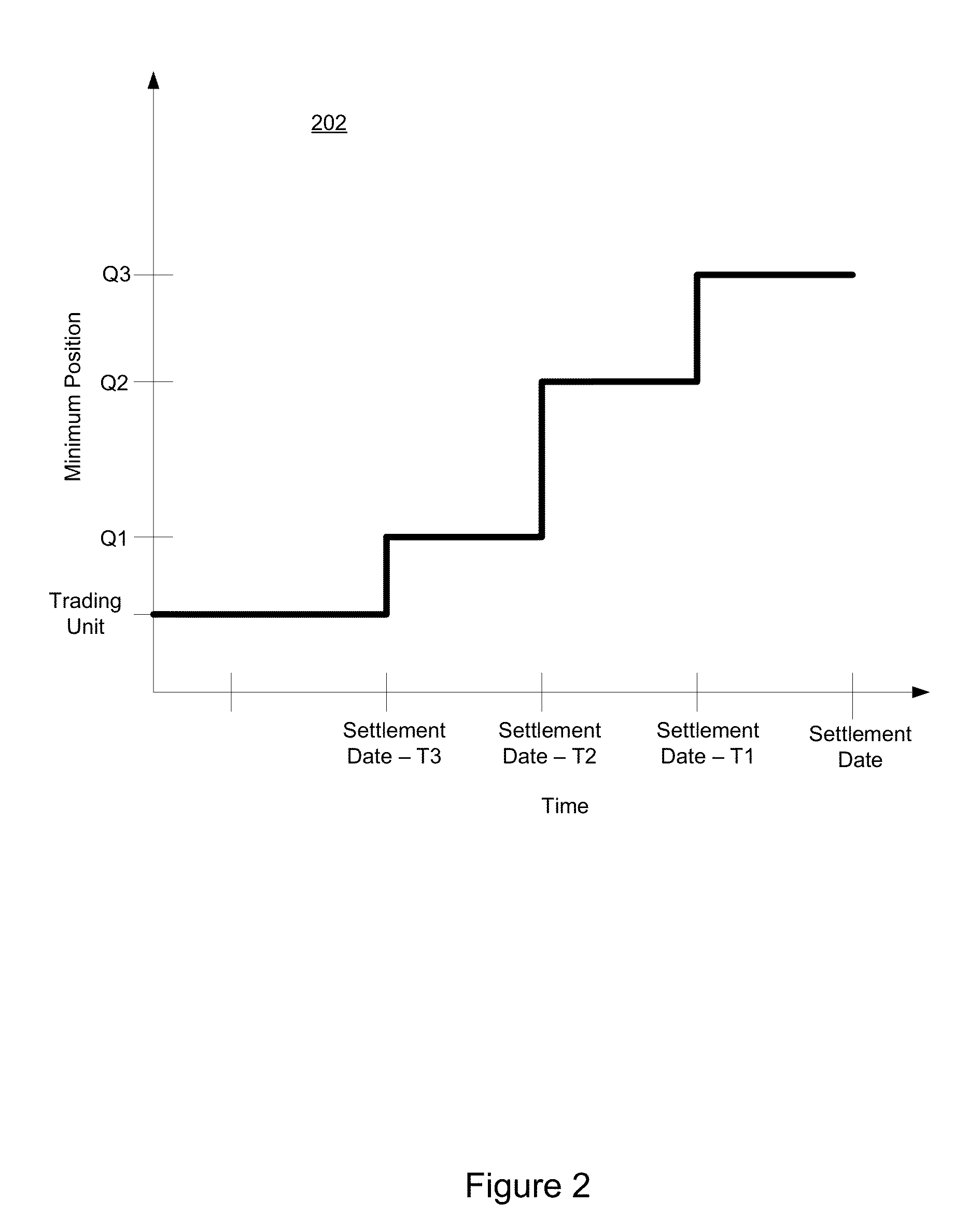

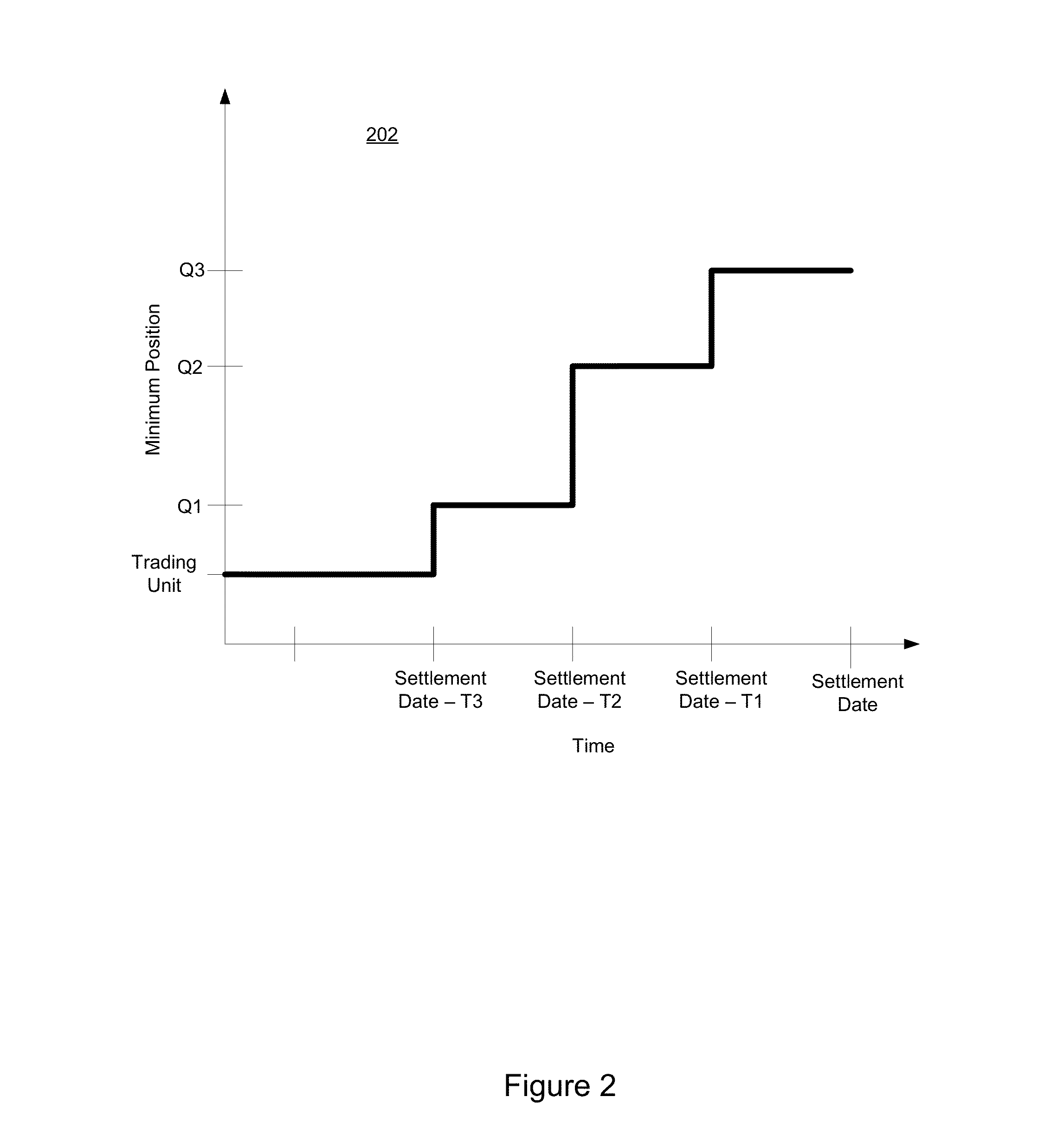

Futures Contracts with Divergent Trading and Delivery Units

Systems and methods are provided for processing derivative financial instrument positions. Contracts are structured to include minimum position limits or thresholds as final settlement dates approach. The minimum position limits or thresholds exceed the trading units. Traders who initially hold relatively small positions are required to increase their positions as the settlement date approaches so that the position at settlement corresponds to quantities used in commercial institutional markets. Limits or thresholds are enforced by imposing a fee for non-compliance, forcing cash settlement or requiring a mandatory roll forward of at least some of the positions. The roll forward may include a spread product that includes a first derivative financial instrument having a first settlement date and a second derivative financial instrument having a second settlement date that is different from the first settlement date. The price of the spread product is based on daily settlement values associated with the first and second derivative financial instruments.

Owner:CHICAGO MERCANTILE EXCHANGE

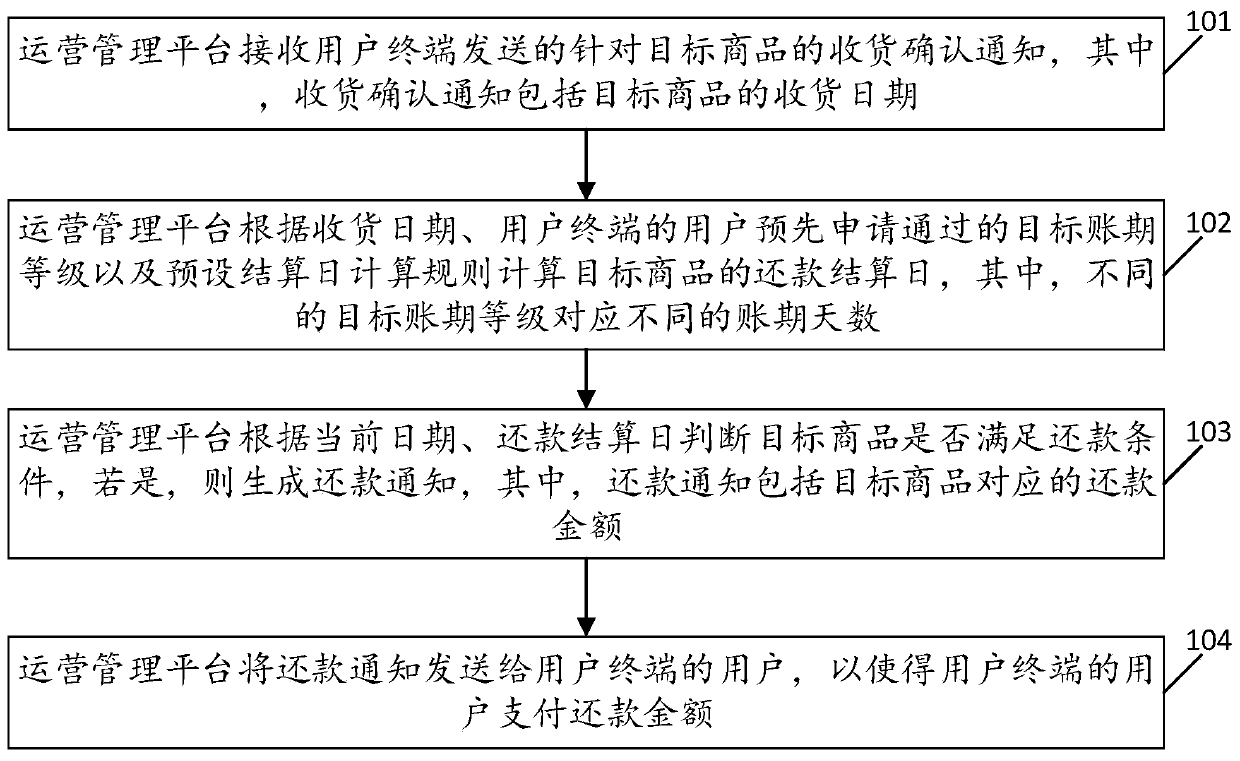

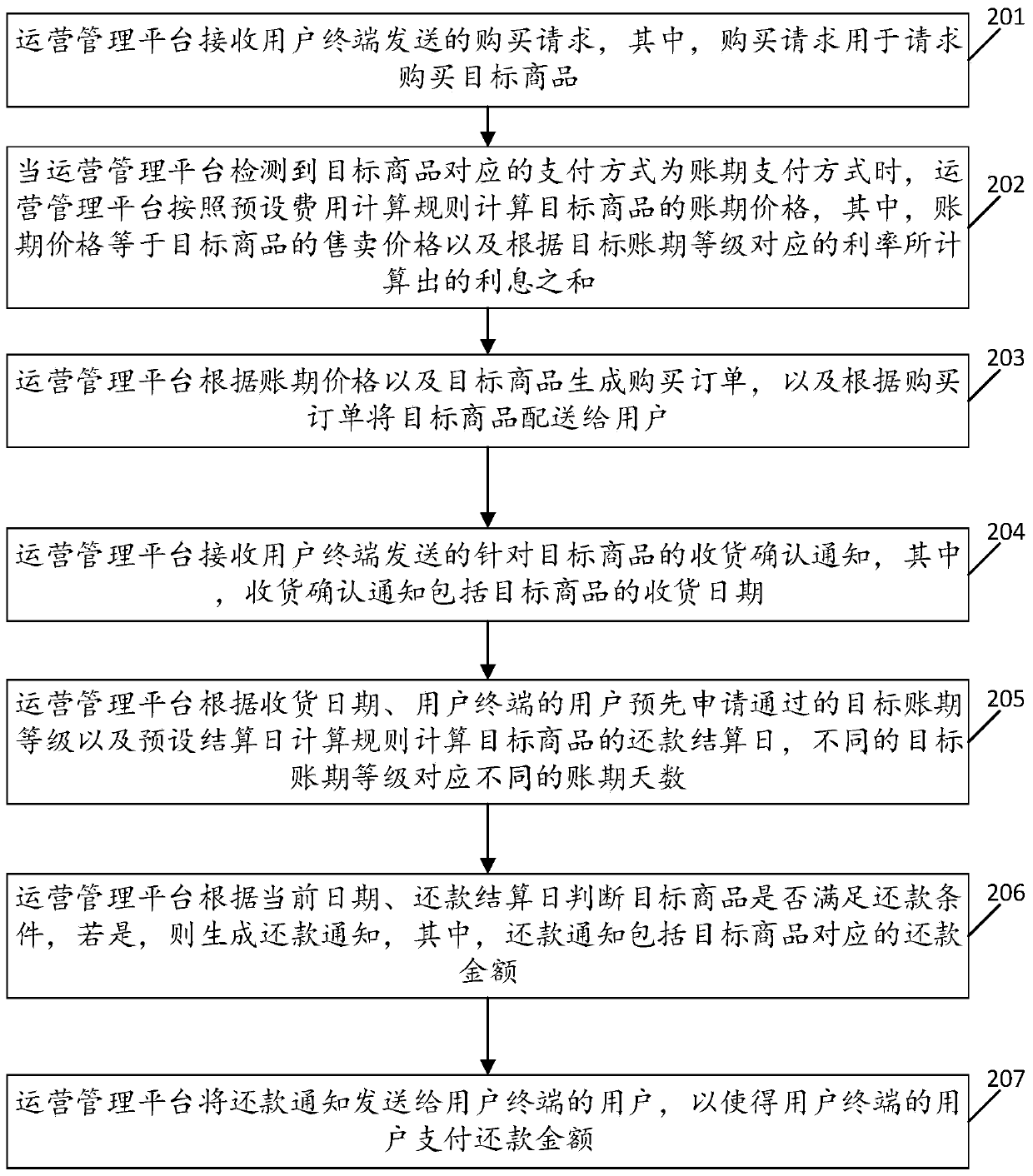

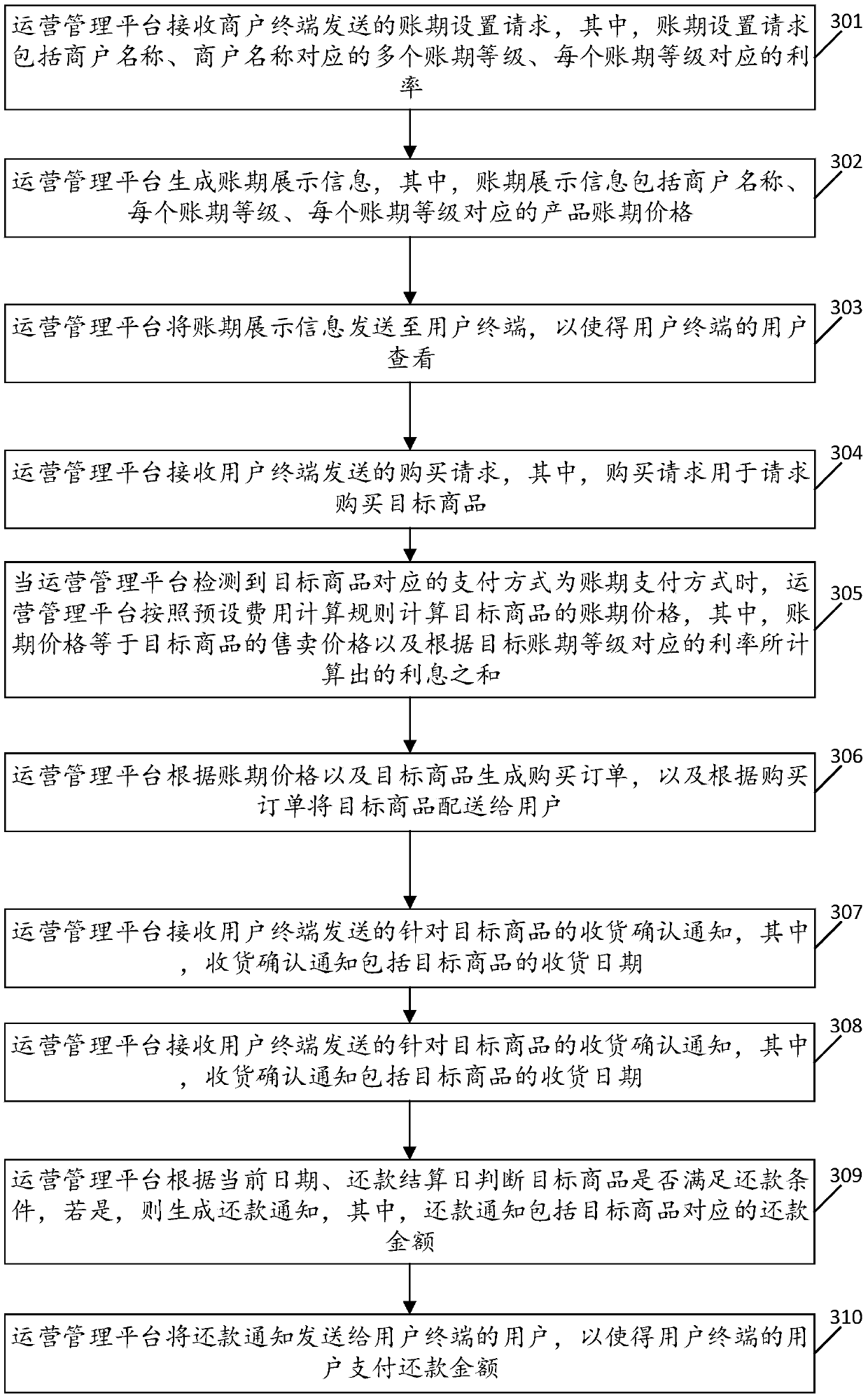

An account transaction settlement method and an operation management platform

InactiveCN109886783AImprove work efficiencyReduce the probability of verification errorsPayment architectureBuying/selling/leasing transactionsComputer scienceSettlement date

The invention discloses an account transaction settlement method and an operation management platform, and the method can comprise the steps that the operation management platform receives a receivingconfirmation notification which is sent by a user terminal and aims at a target commodity, and the receiving confirmation notification comprises a receiving date of the target commodity; the operation management platform calculates a repayment settlement day of the target commodity according to the receiving date, a target account number level passed by a user of the user terminal in advance anda preset settlement day calculation rule, wherein different target account number levels correspond to different account number days; the operation management platform judges whether the target commodity meets a repayment condition or not according to the current date and the repayment settlement date, if yes, a repayment notification is generated, and the repayment notification comprises the repayment amount corresponding to the target commodity; and the operation management platform sends the repayment notification to the user of the user terminal, so that the user of the user terminal paysthe repayment amount. According to the invention, the reconciliation efficiency of the enterprise reconciliation period bill can be improved.

Owner:GUANGZHOU GELI NETWORK TECH CO LTD

Operational risk back-testing process using quantitative methods

Methods, computer-readable media, and apparatuses are disclosed for quantifying risk and control assessments. The risk includes both residual risk and direction of risk. Various aspects of the invention quantitatively compare the risk and control assessments against step-ahead losses using special regression models that are particularly applicable to this kind of data. The empirical comparison may be performed on both loss event frequency and severity in two different and separate dimensions. The empirical comparison may also be performed using losses extracted by even occurrence and event settlement dates in two separate dates.

Owner:BANK OF AMERICA CORP

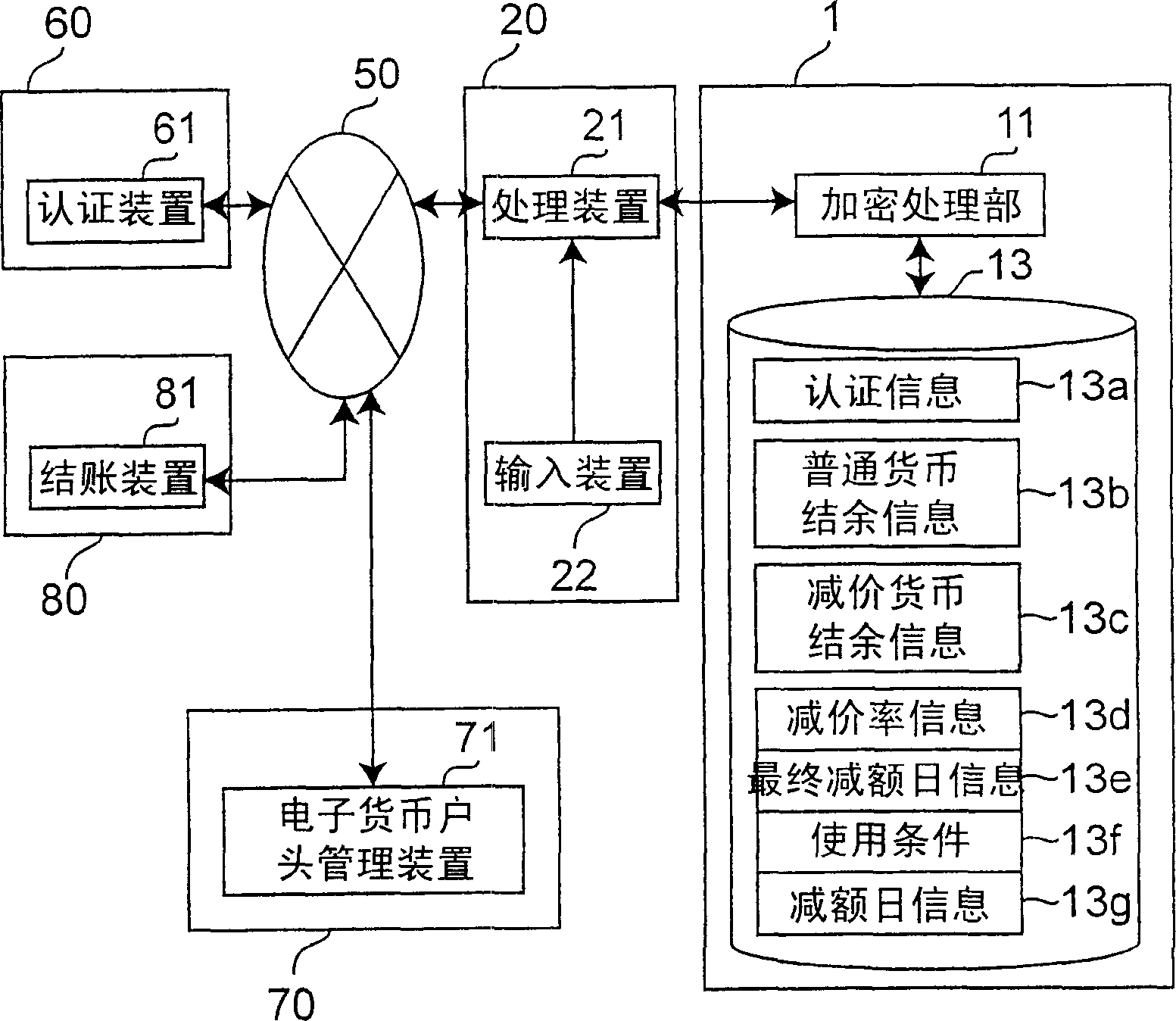

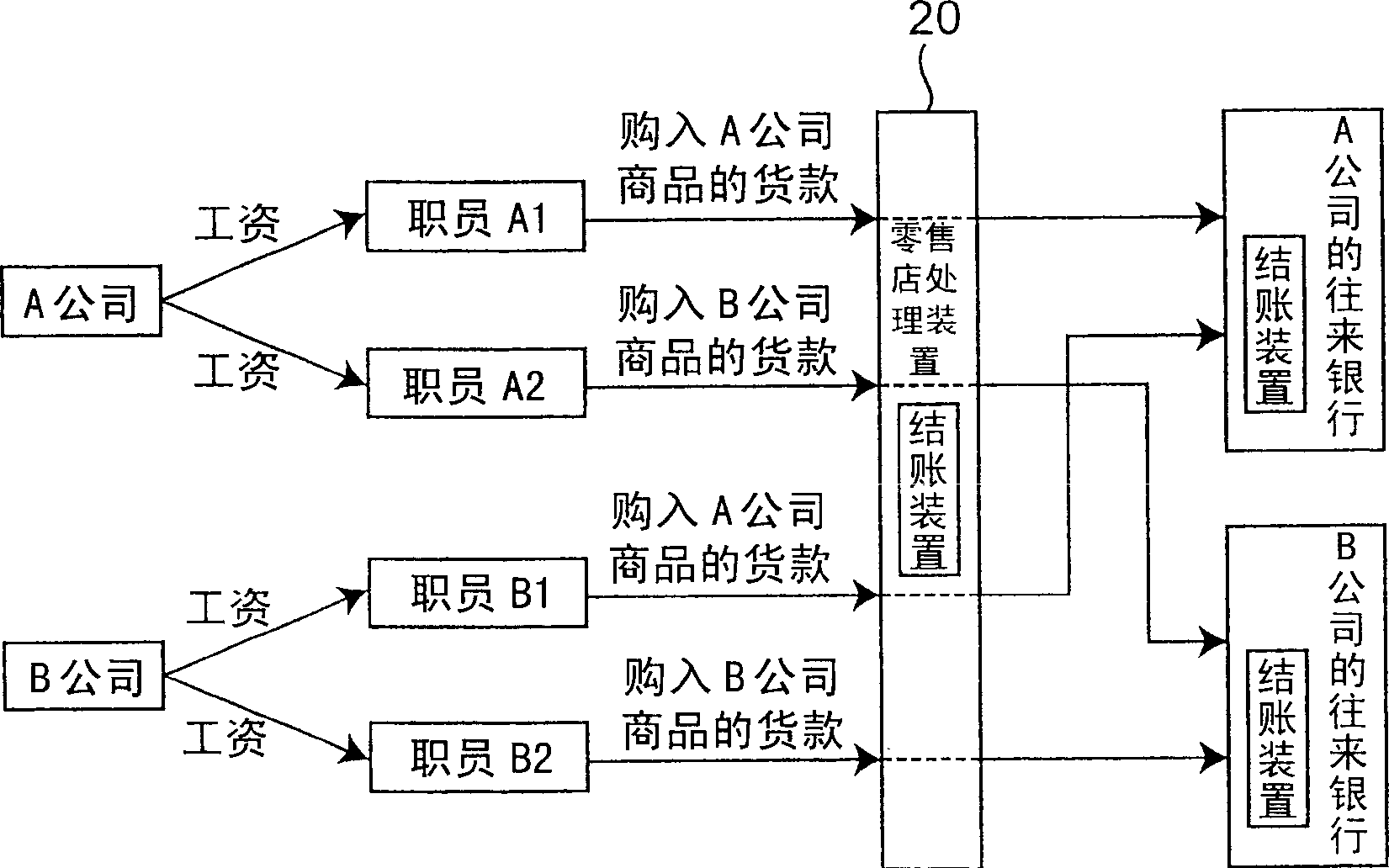

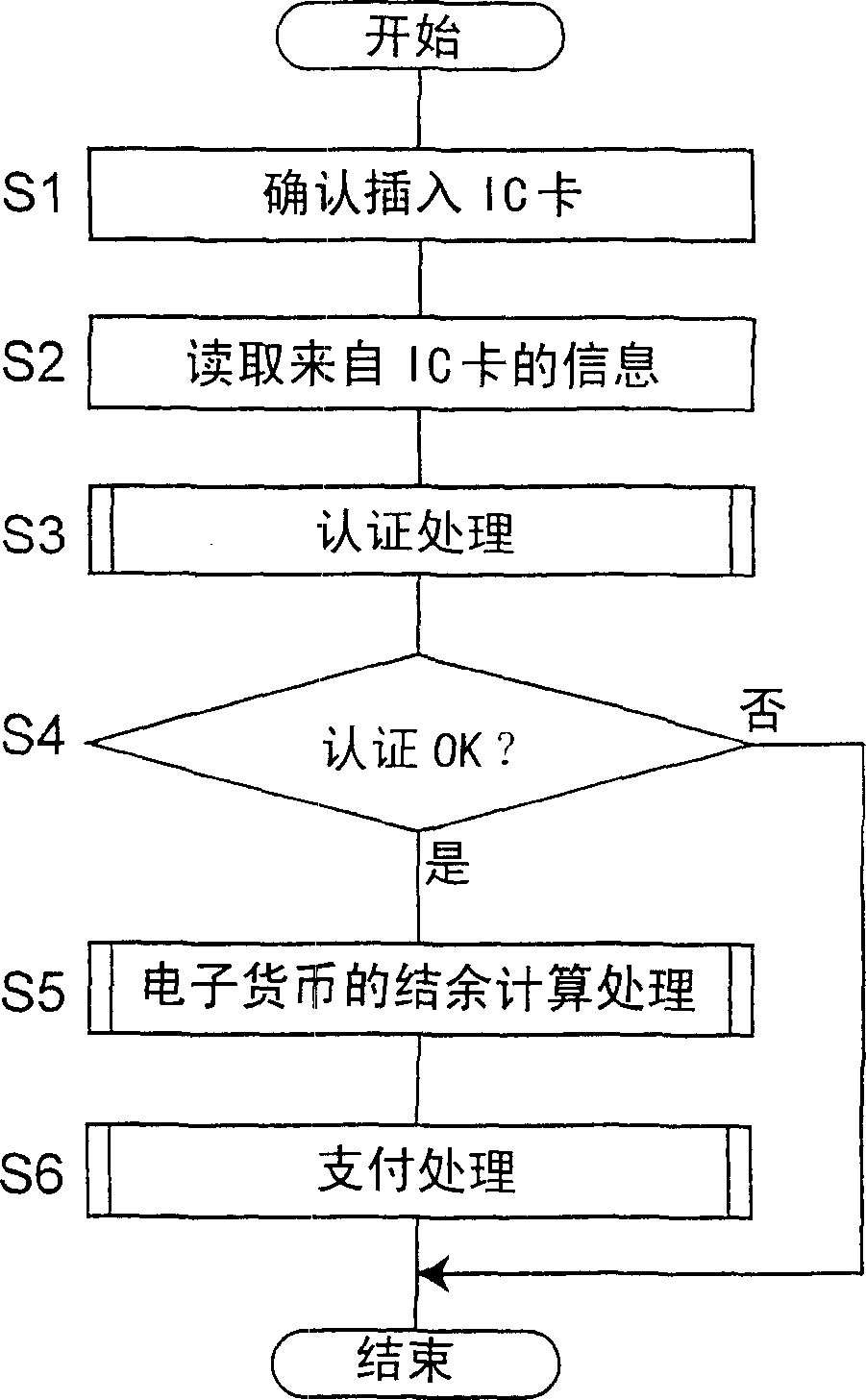

Electronic settlement method and electronic money recording medium and processing device

InactiveCN1705951AActive consumptionSpecial data processing applicationsCoded identity card or credit card actuationComputer scienceSettlement date

Owner:PANASONIC CORP

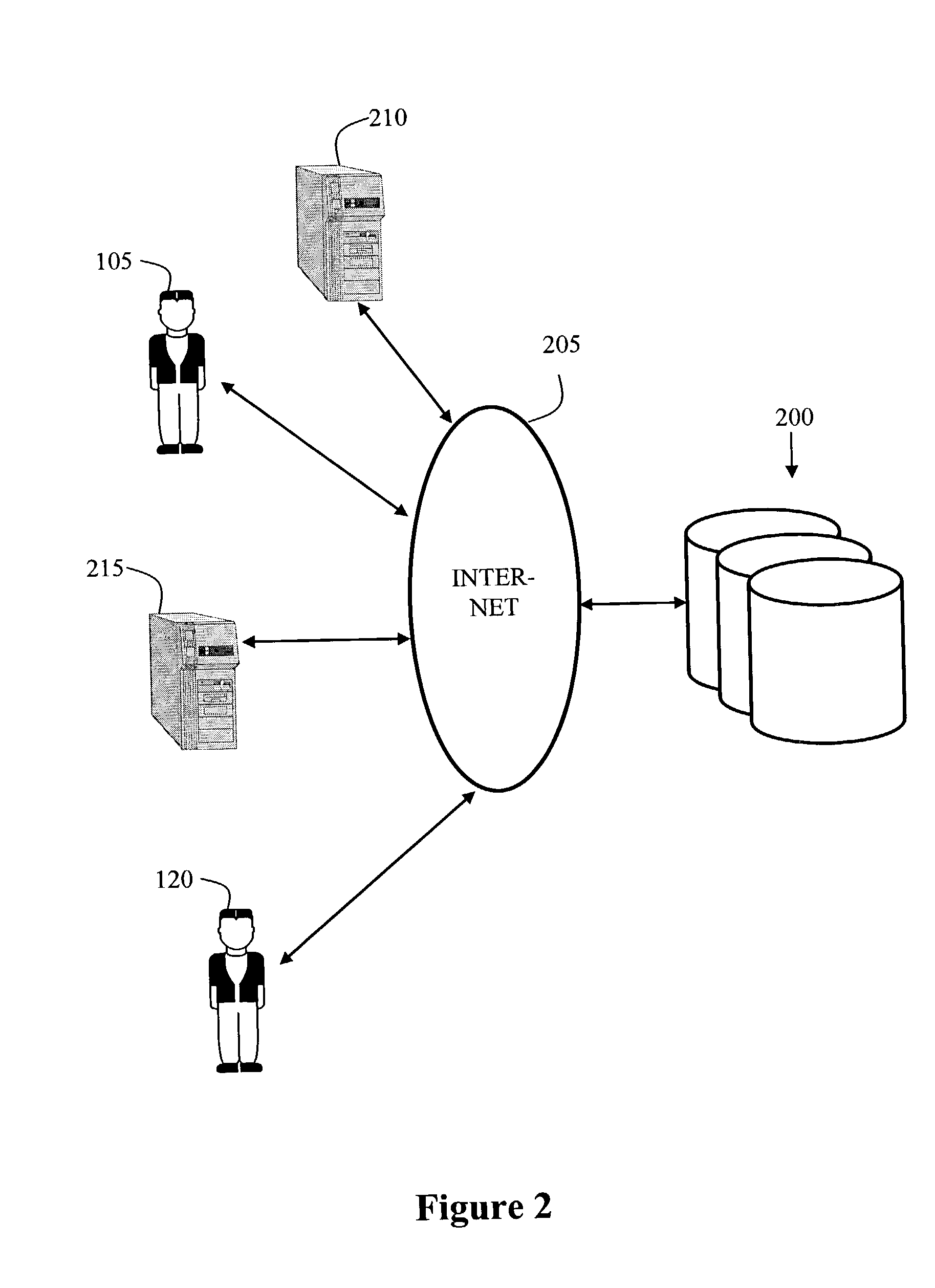

Internet based release tracking system

An Internet based real estate transaction and release tracking system that insures deeds of trust, liens and other encumbrances are released in a timely manner after the lien holder has received payment for the underlying obligation. Based on information provided by an agent, such as an escrow agent or a settlement agent, the system creates a unique electronic record for each real estate transaction entered by the agent. The system receives update information, either automatically from other computers or via manual input from searchers, and uses this update information to track each real estate transaction. The system monitors the records and indicates when a lien holder has failed to release their lien after a statutory time period that begins after the passing of the settlement date. When the statutory time period has passed, the system generates a number of forms, including a demand letter. The demand letter is sent to the lien holder demanding them to release the lien. If the lien is not thereafter released, further legal documents can be generated and sent to a law firm for legal action to be taken against the delinquent lien holder.

Owner:LENDERLIVE SERVICES LLC

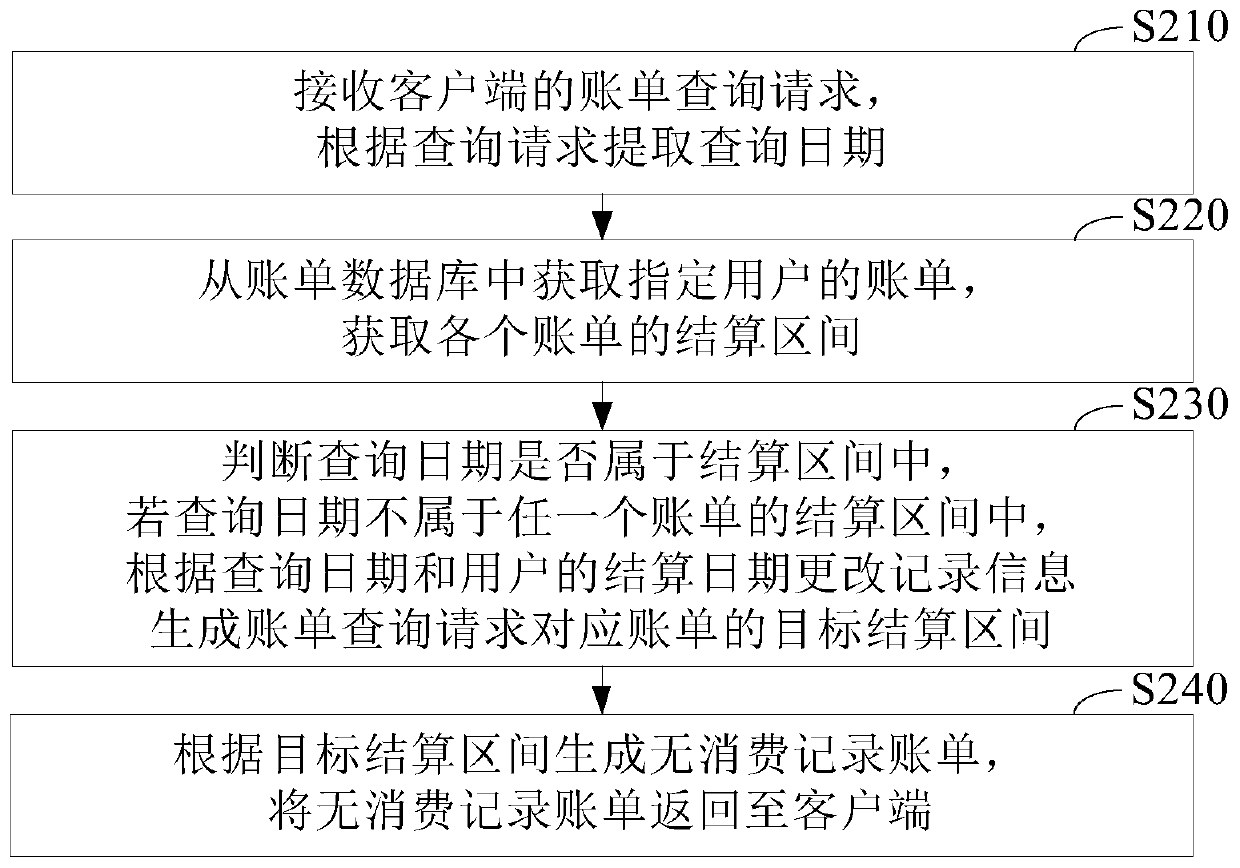

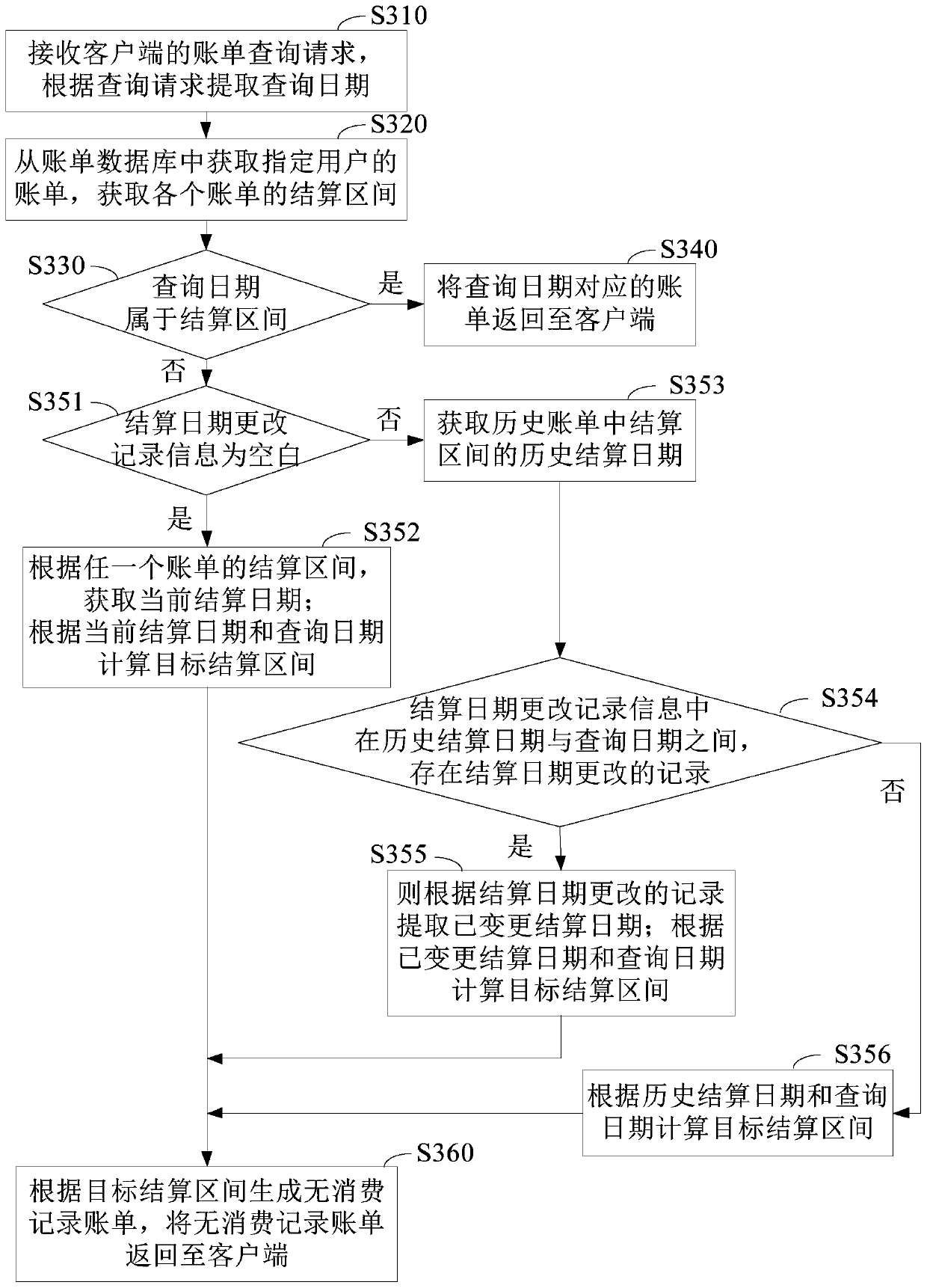

Bill processing method and system, computer equipment and storage medium

PendingCN110321461AImprove query performanceAvoid unresponsive situationsFinanceOther databases queryingData querySettlement date

The invention relates to the technical field of data query, and provides a bill processing method and system, computer equipment and a storage medium, and the method comprises the steps: receiving a bill query request of a client, and extracting a query date according to the query request; obtaining a bill of a specified user from a bill database, and obtaining a settlement interval of each bill;if the query date does not belong to the settlement interval of any bill, generating a target settlement interval of the bill corresponding to the bill query request according to the query date and the settlement date change record information of the user; and generating a consumption-record-free bill according to the target settlement interval, and returning the consumption-record-free bill to the client. According to the bill processing method, after the bill corresponding to the query date cannot be found, the settlement interval corresponding to the query date is obtained, the corresponding bill without the consumption record is generated according to the blank consumption record and the settlement interval and returned to the client, the situation that the query request has no response is avoided, and the bill query effect is improved.

Owner:PING AN BANK CO LTD

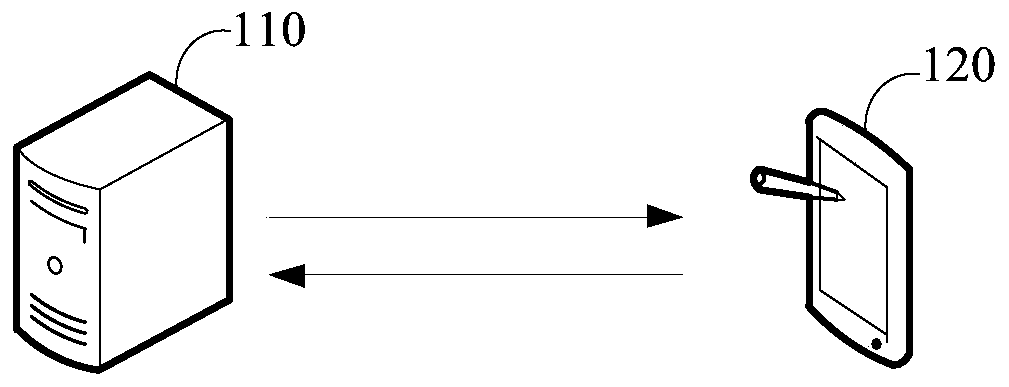

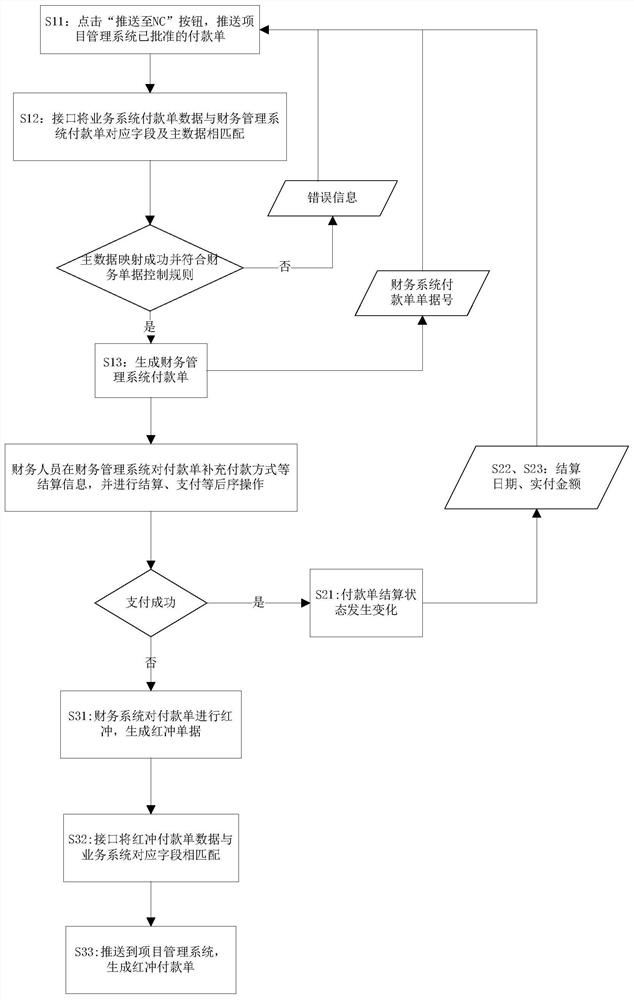

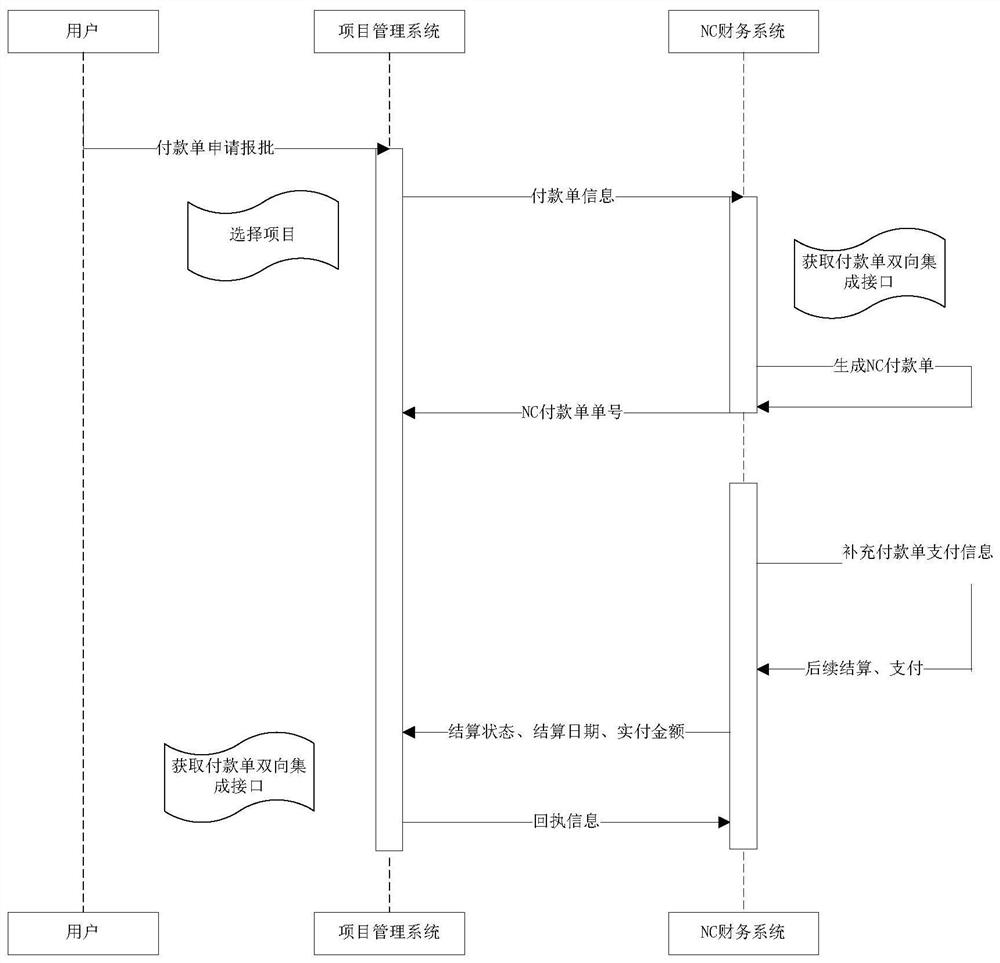

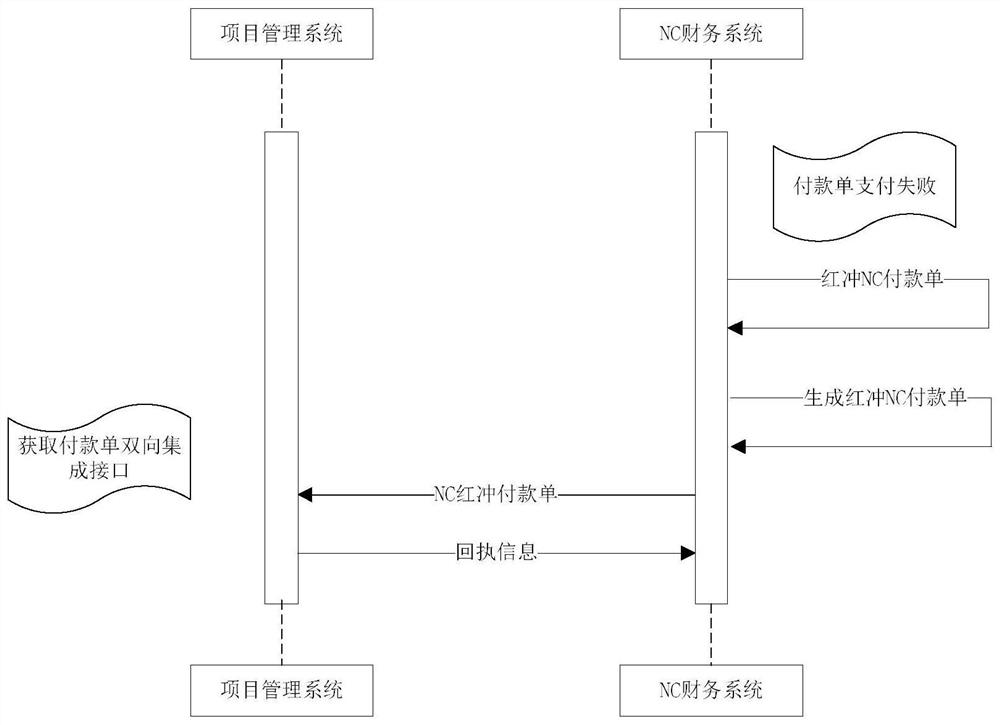

Data transmission method for payment bill integrated interface of project management system and NC financial system

PendingCN112016894AAchieve sharingReduce data entryDatabase management systemsFinanceBusiness PersonnelPayment order

The invention discloses a data transmission method for a payment bill integrated interface of a project management system and an NC financial system. The method is based on a project management systemand an NC financial system. The project management system and the NC financial system can carry out data transmission through a bidirectional integrated interface. The project management system pushes an approved payment order to the NC financial system, obtains the settlement state, the settlement date and the actual payment amount of the payment order from the NC financial system in real time,and pushes a Hongchong payment order to the project management system. According to the data transmission method adopted by the integrated interface, sharing of payment orders among heterogeneous systems and real-time write-back of bill settlement states can be achieved, the data input amount of business personnel and financial personnel is reduced, and the business personnel can conveniently master the settlement states of the payment orders in a business system in real time.

Owner:XIAN THERMAL POWER RES INST CO LTD

Futures Contracts Settlement Method with Option to Roll Forward

Systems and methods are provided for processing derivative financial instrument positions. Contracts are structured to include minimum position limits or thresholds as final settlement dates approach. The minimum position limits or thresholds exceed the trading units. Traders who initially hold relatively small positions are required to increase their positions as the settlement date approaches so that the position at settlement corresponds to quantities used in commercial institutional markets. Limits or thresholds are enforced by imposing a fee for non-compliance, forcing cash settlement or requiring a mandatory roll forward of at least some of the positions. The roll forward may include a spread product that includes a first derivative financial instrument having a first settlement date and a second derivative financial instrument having a second settlement date that is different from the first settlement date. The price of the spread product is based on daily settlement values associated with the first and second derivative financial instruments.

Owner:CHICAGO MERCANTILE EXCHANGE

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com