Patents

Literature

53results about How to "Reduce data entry" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

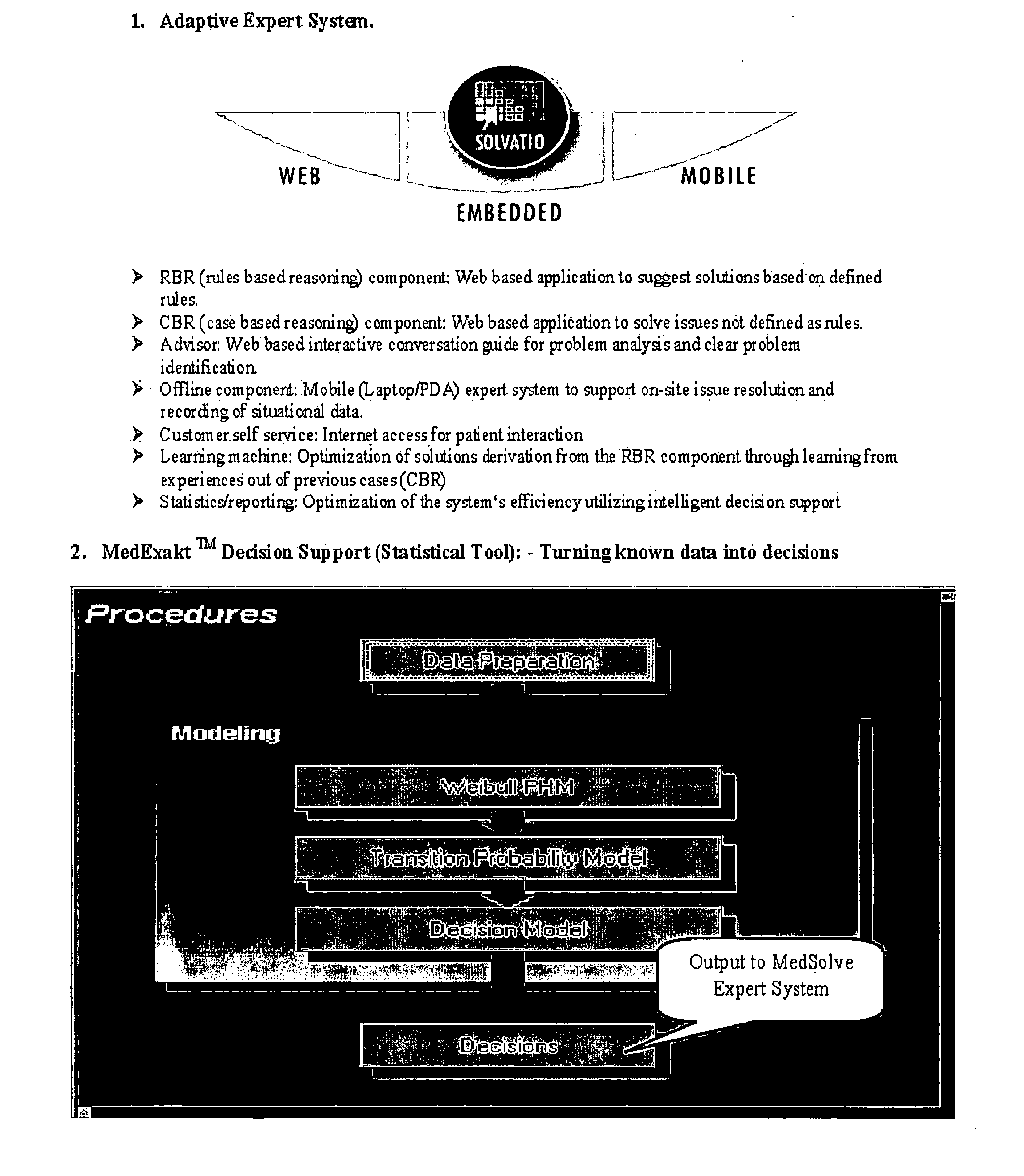

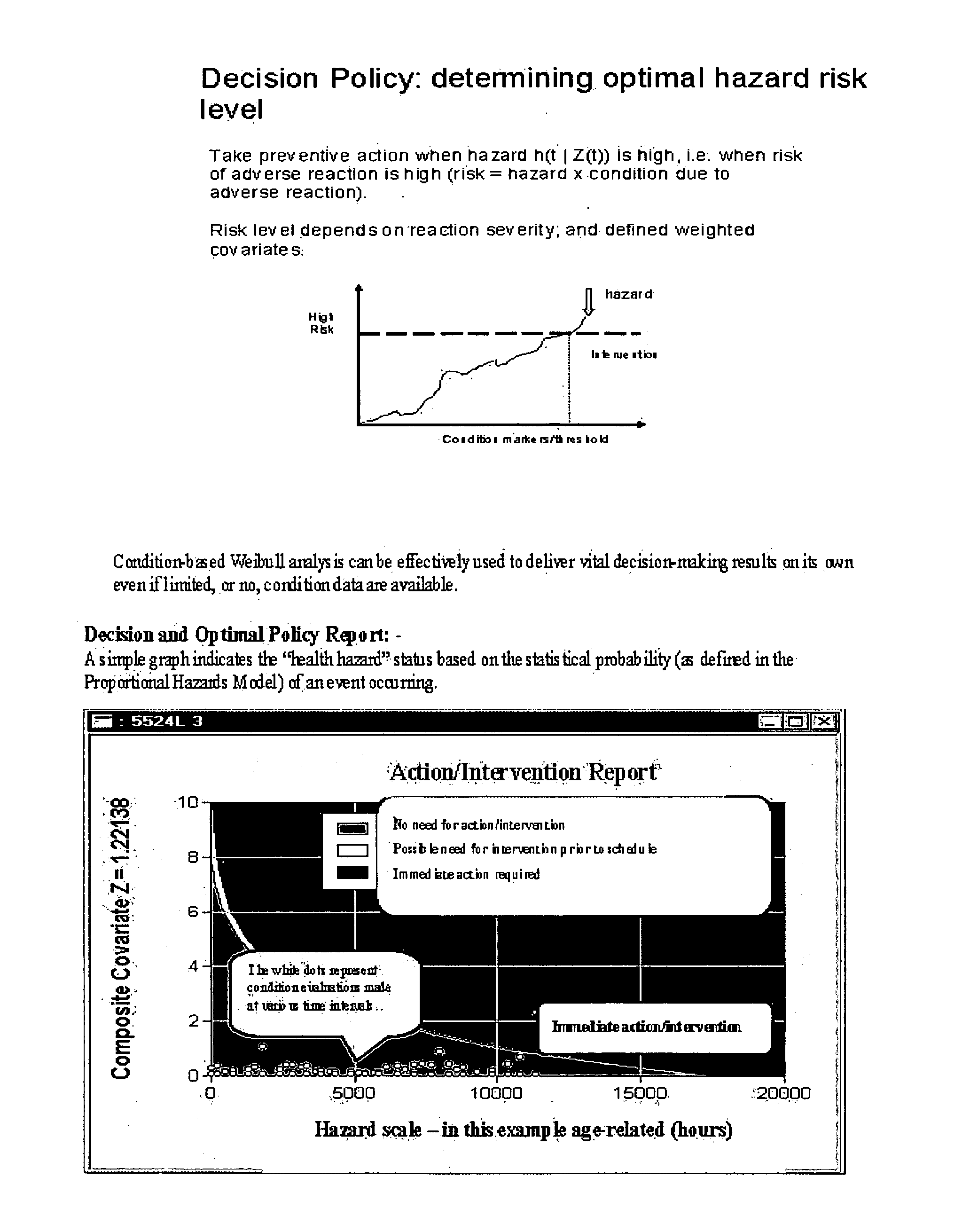

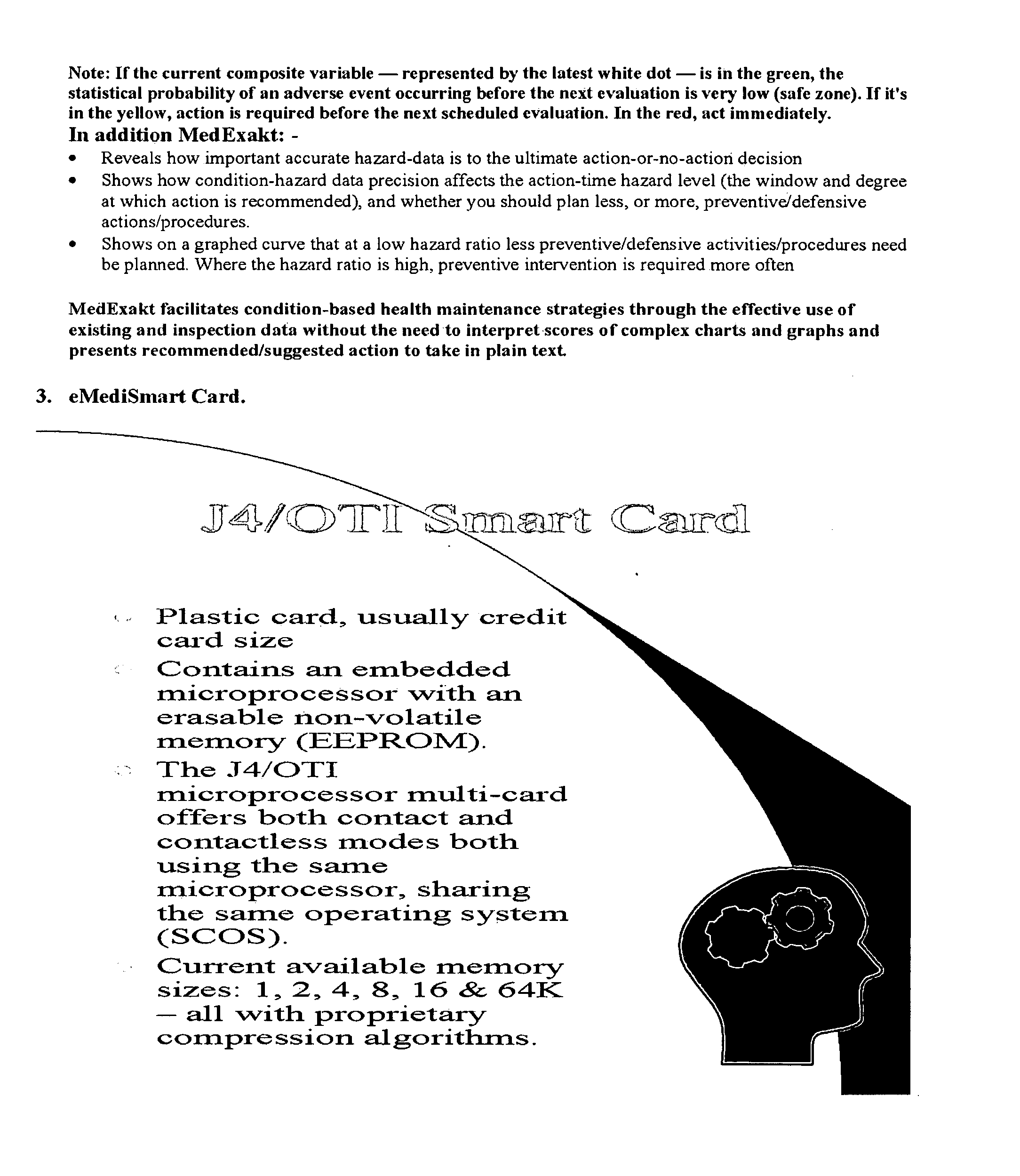

Portable medical information system

InactiveUS20060173712A1Negates needGenerate revenueMedical data miningMedical automated diagnosisComputerized systemSmart card

A computerized system for monitoring and maintaining the health of a person comprising the steps of (a) obtaining parameter data from the patient and inputting the parameter data into a computer database; (b) analyzing the parameter data using a computerized statistical modeling technique module and a computerized adaptive expert system shell for the prediction of a health event in the lifetime of the patient; (c) using the analyzed data to developed a health maintenance schedule for the patient, and (d) embedding and / or linking such data onto a microprocessor powered smart card.

Owner:JOUBERT DIRK

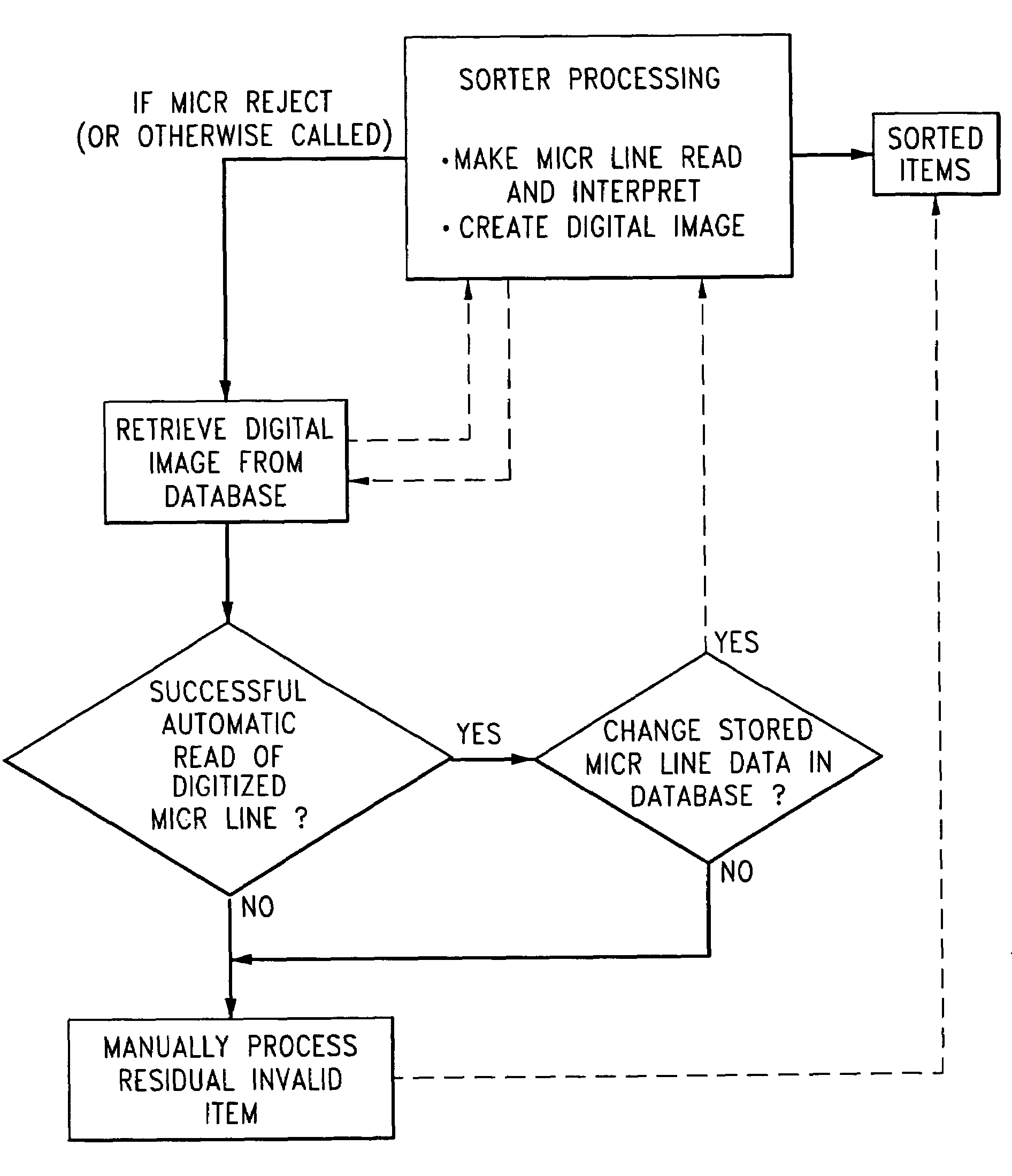

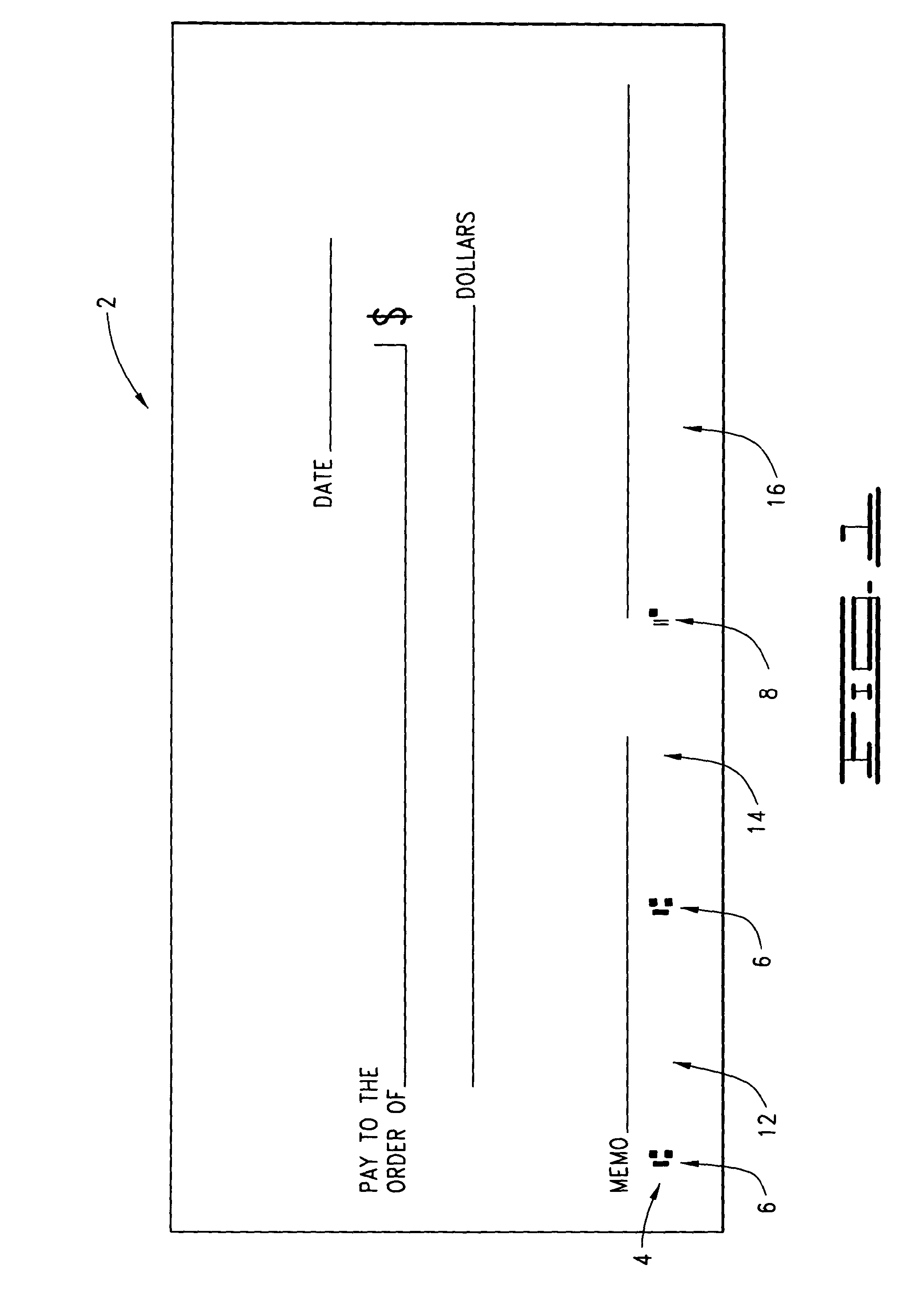

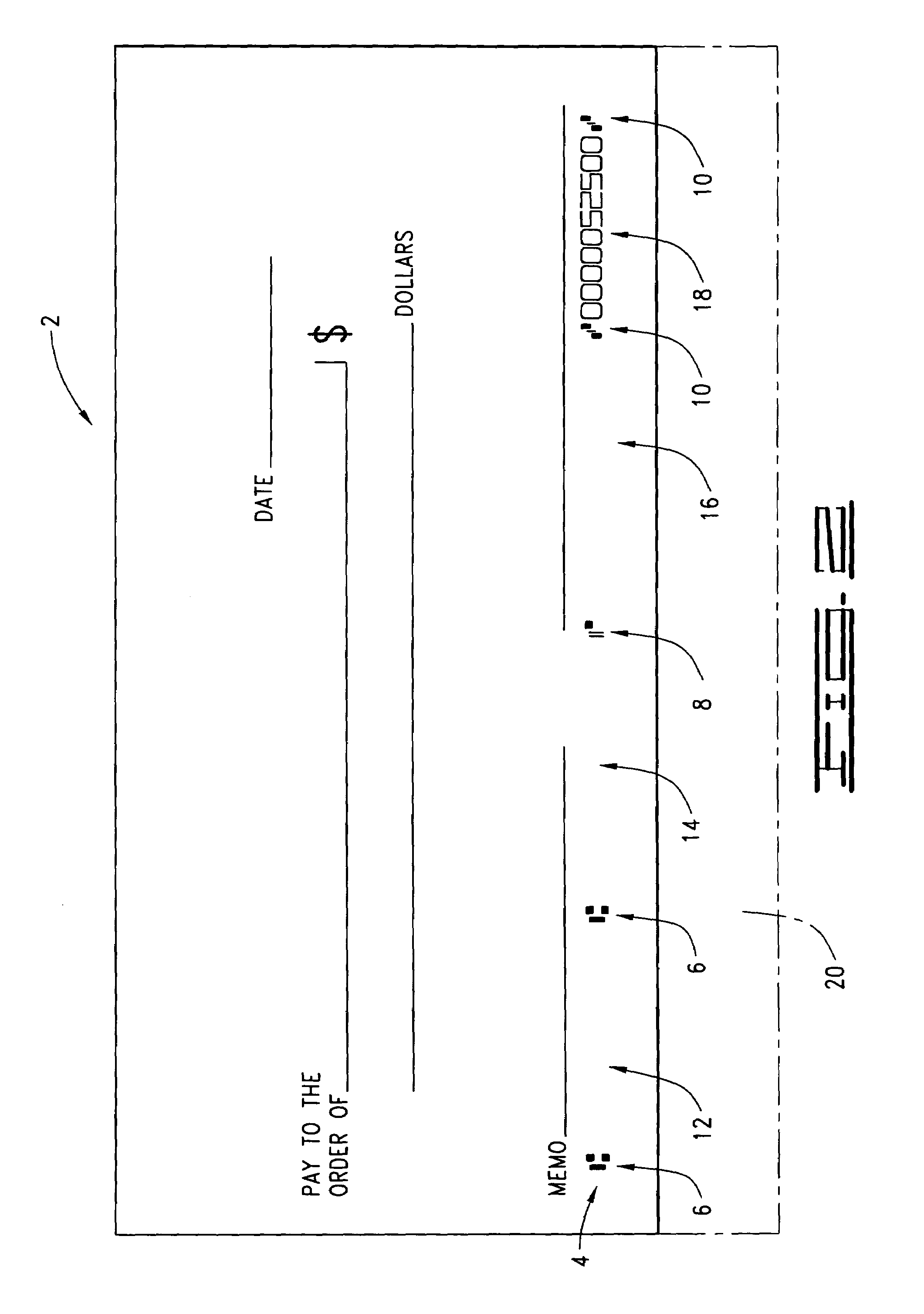

Character recognition, including method and system for processing checks with invalidated MICR lines

InactiveUS7092561B2Reduce data entryFaster postingCharacter and pattern recognitionCharacter recognitionOptical character recognition

An automated analysis method and tool for a digitally imaged financial item can digitally recognize a plurality of characters across an area of a digital image containing character indicia at predetermined positions in the area and also possibly containing non-character indicia in the area. This finds exemplification in an automated check processing method and check sorting system in which a check's MICR line that has been read and interpreted as invalid can be digitally analyzed, via a digital image of the check, to identify MICR characters that could not be validly read or interpreted by the conventional MICR processing equipment. This includes digitally applying character recognition processing to an invalidated MICR line in a digital image of the financial item (e.g., a check). Previously invalidated MICR line data can then be corrected.

Owner:ADVANCED FINANCIAL SOLUTIONS

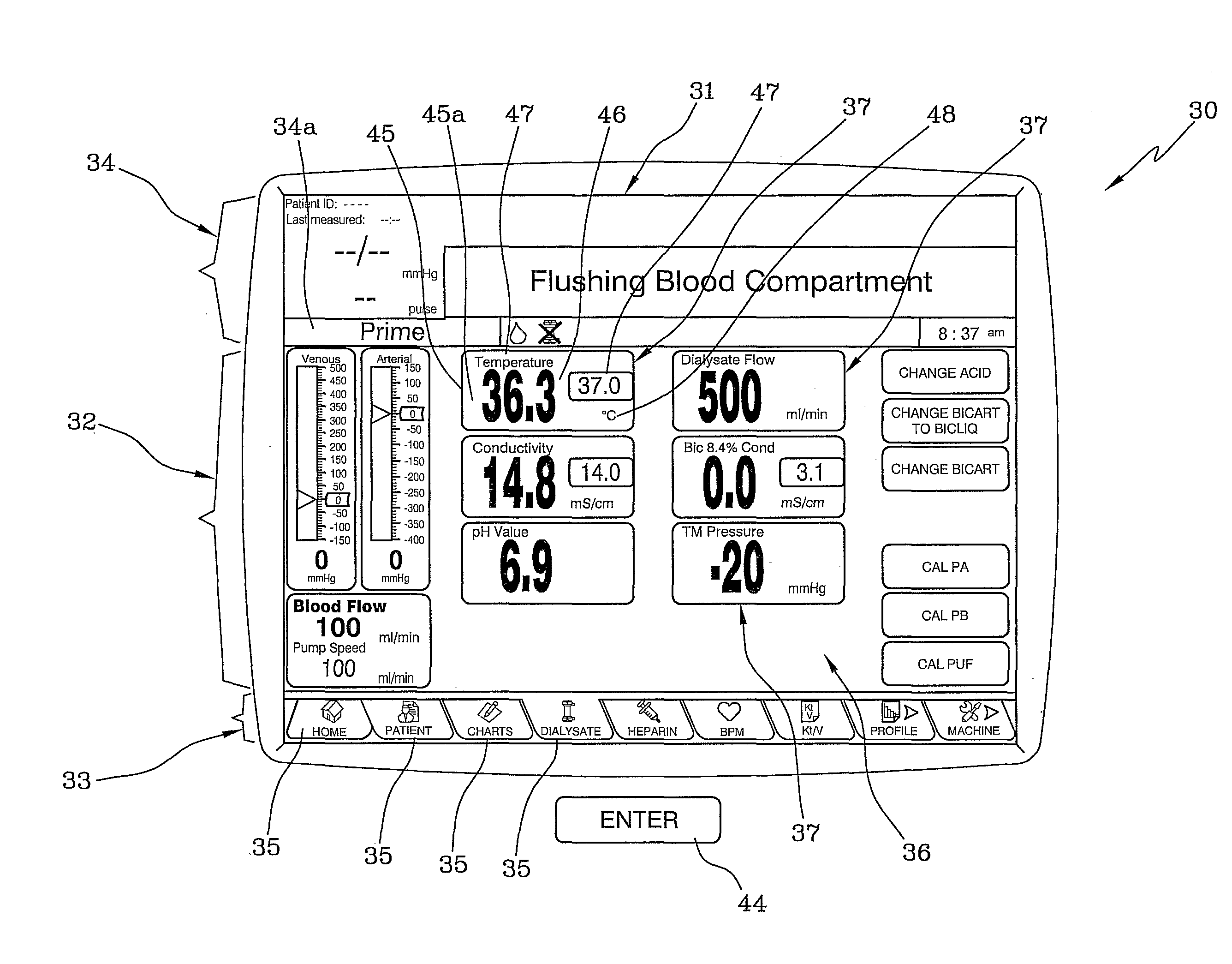

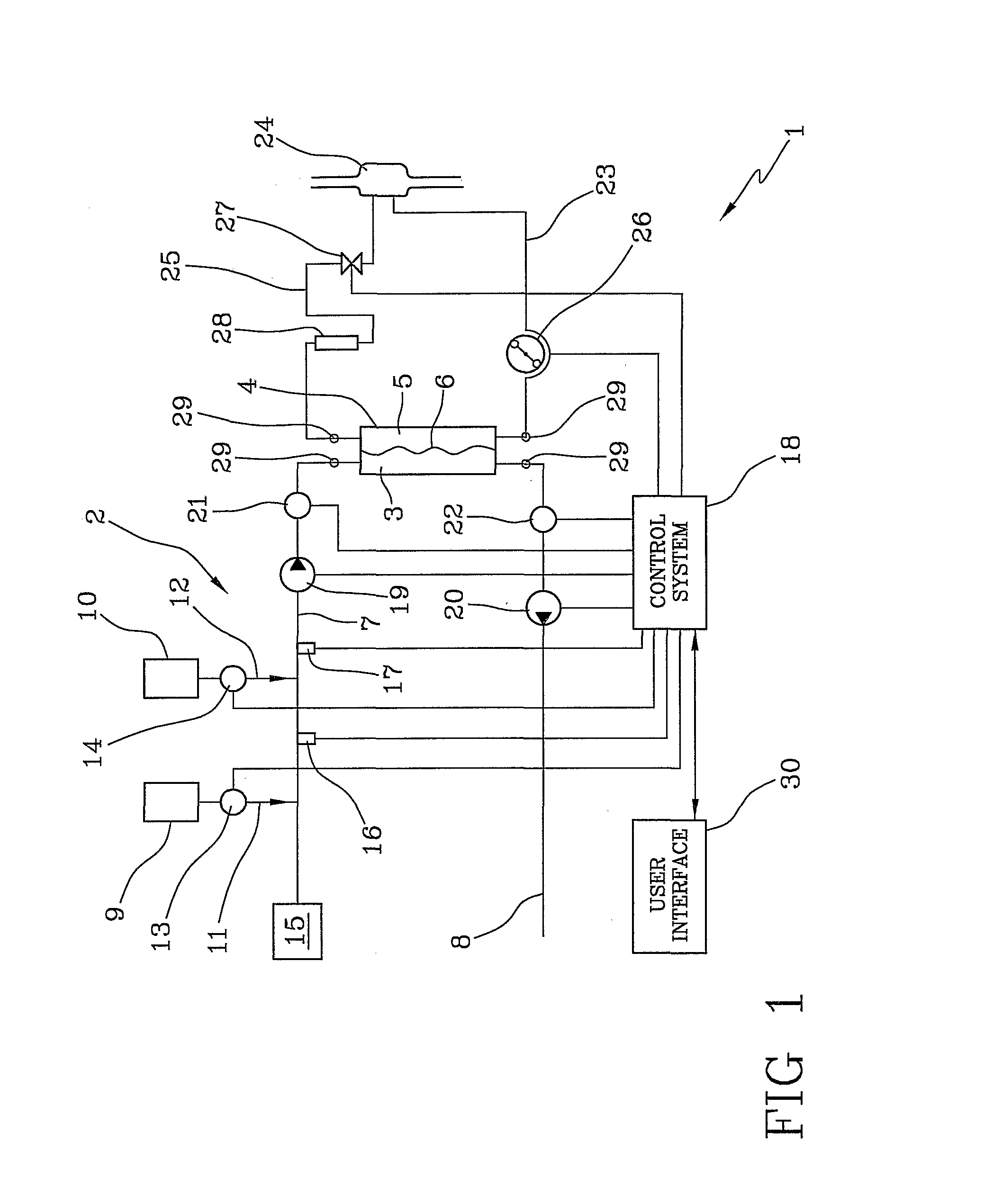

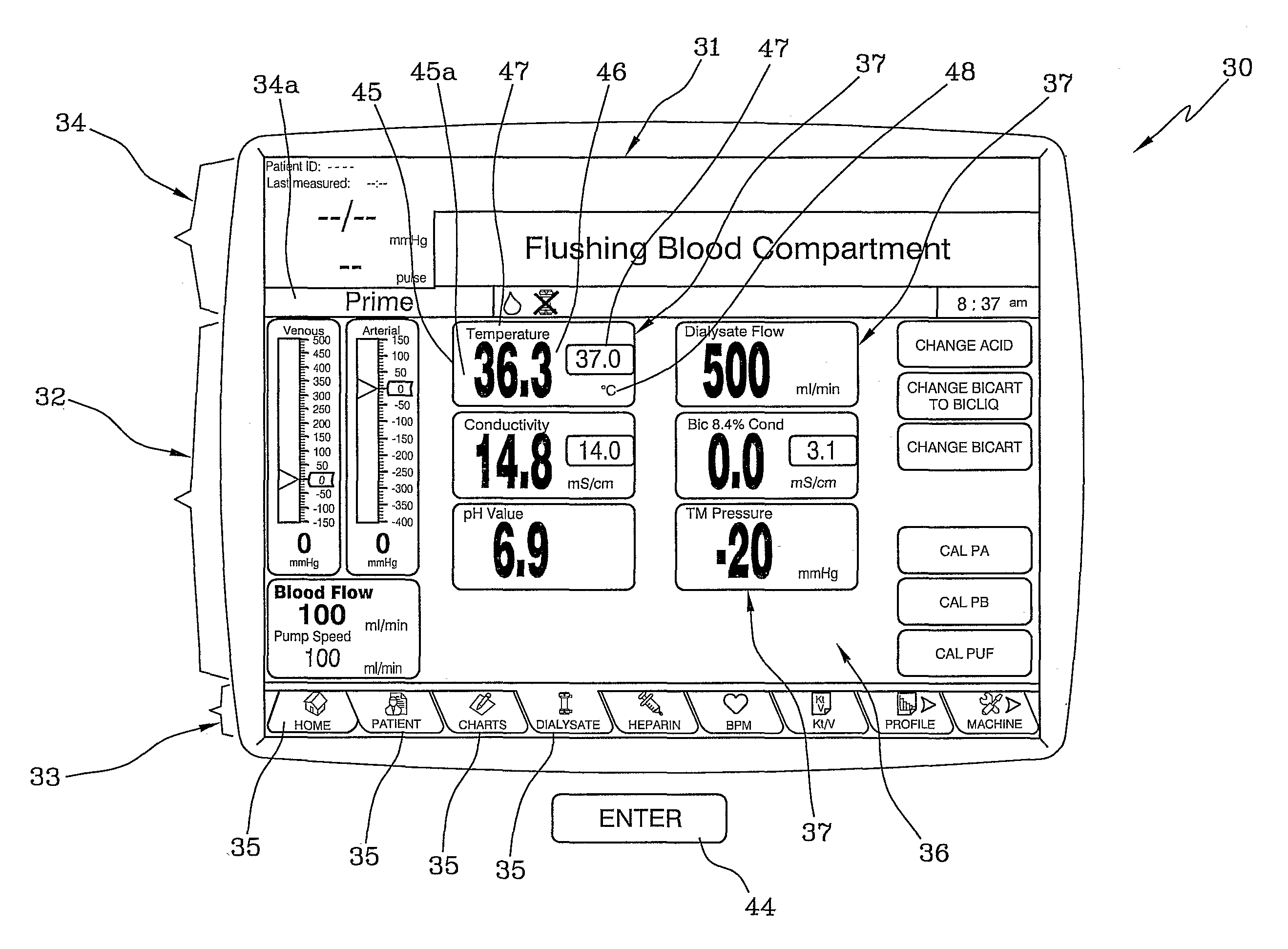

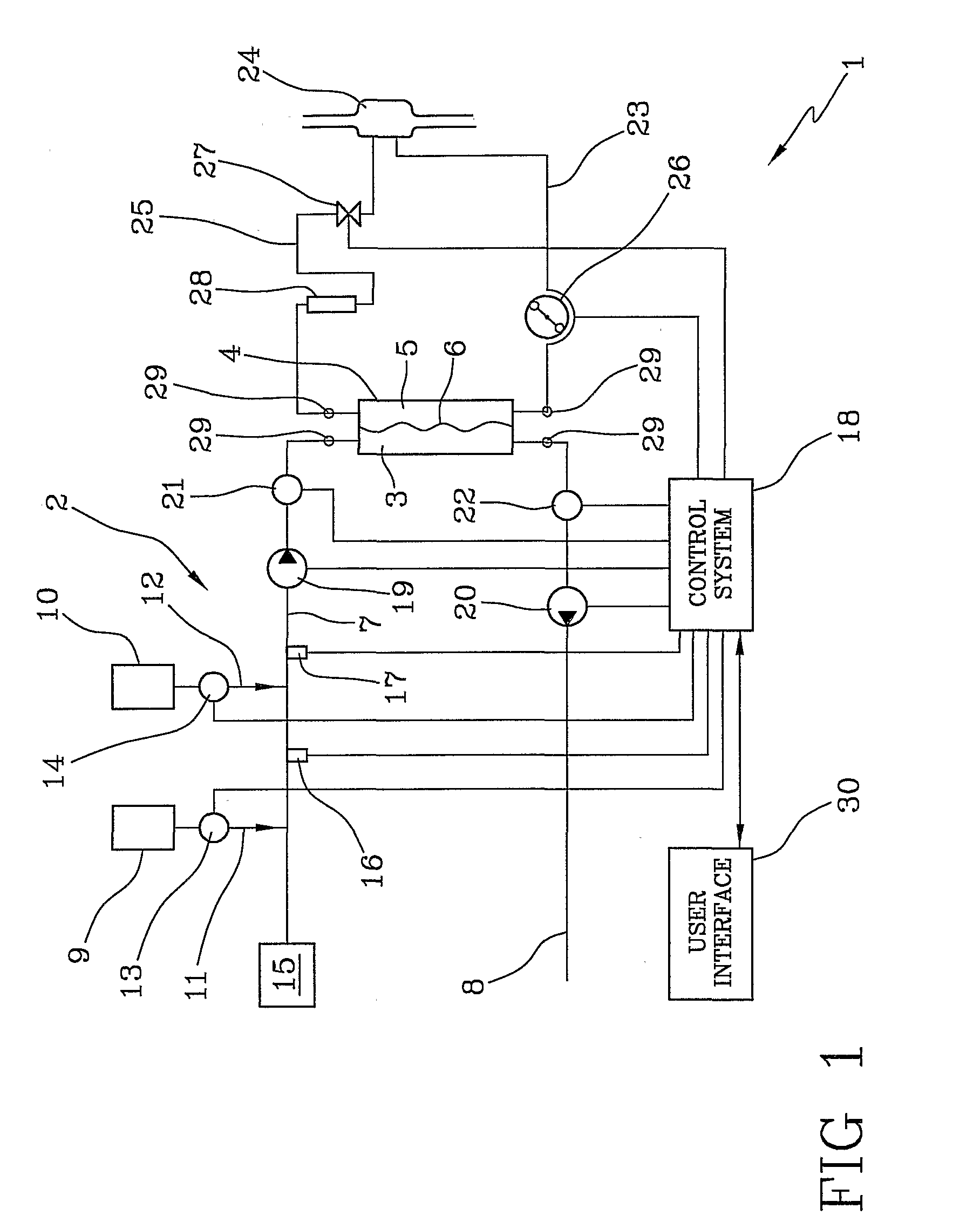

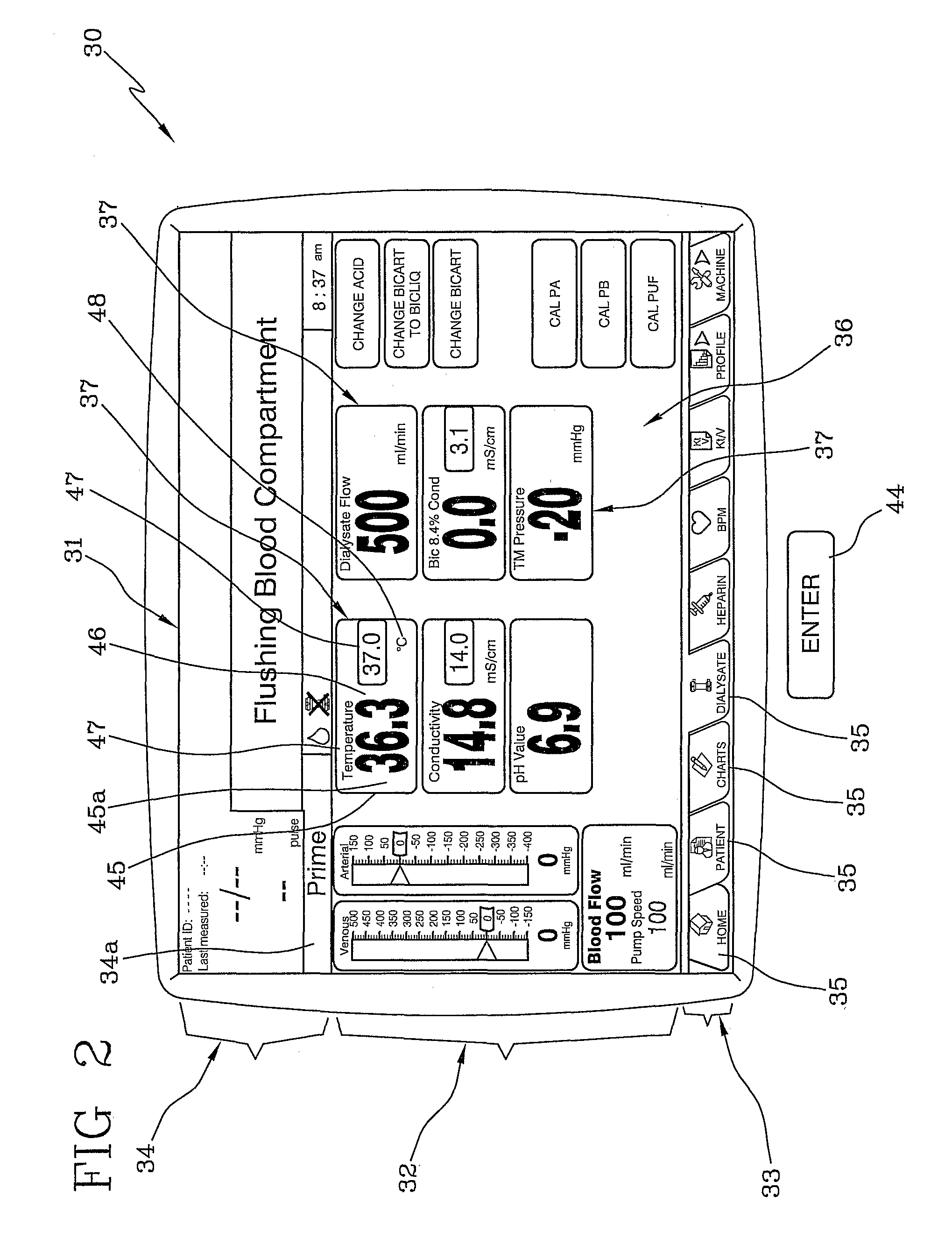

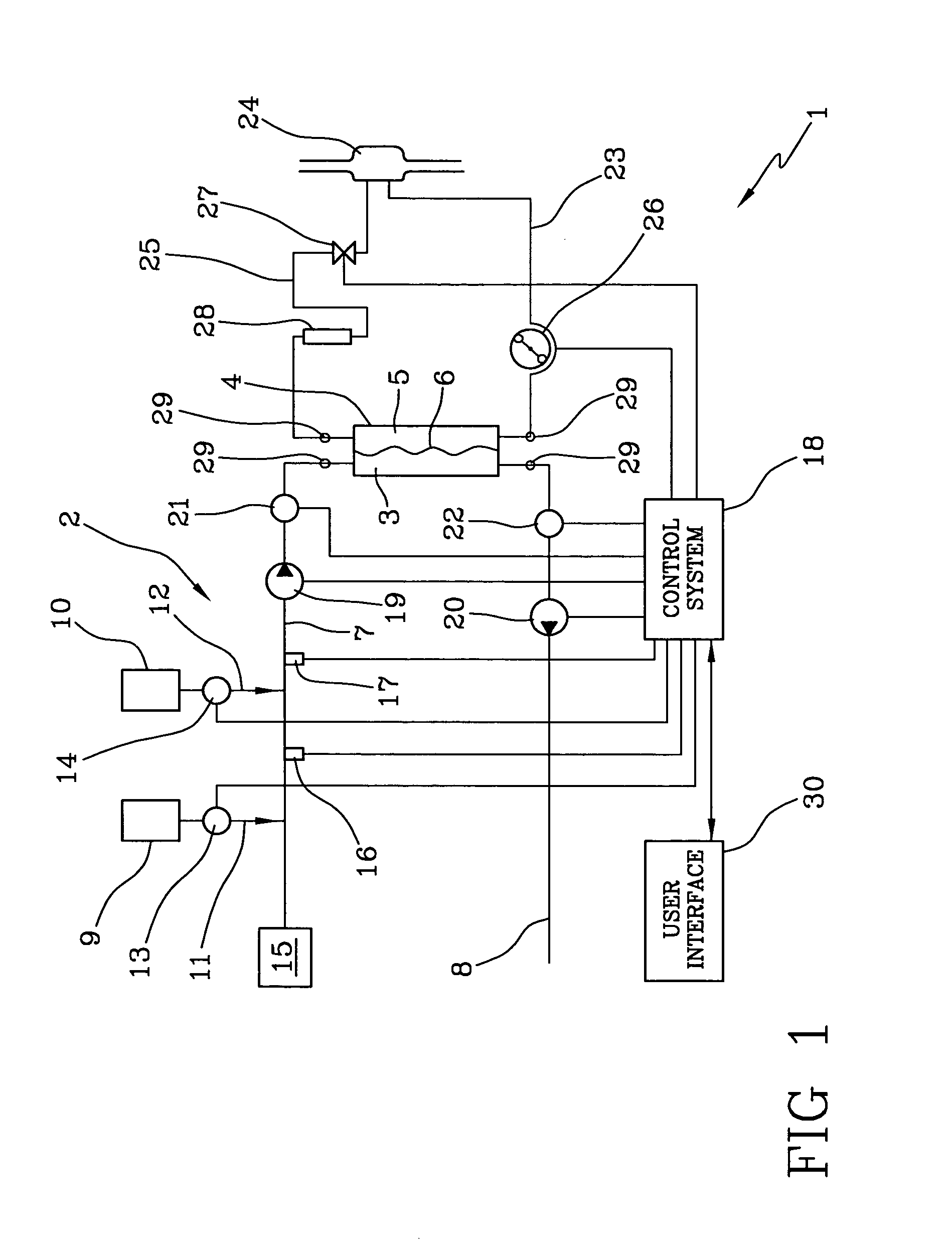

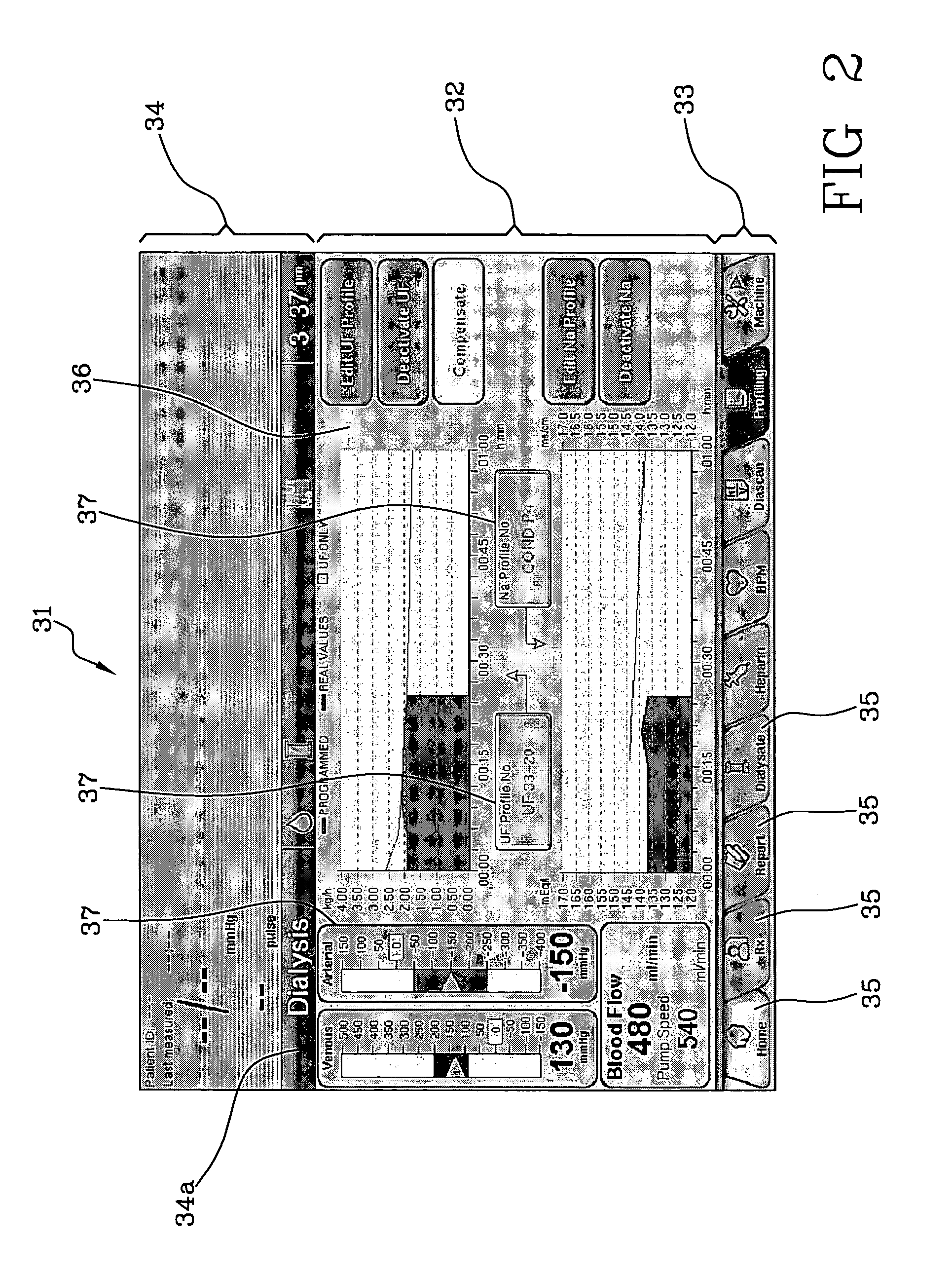

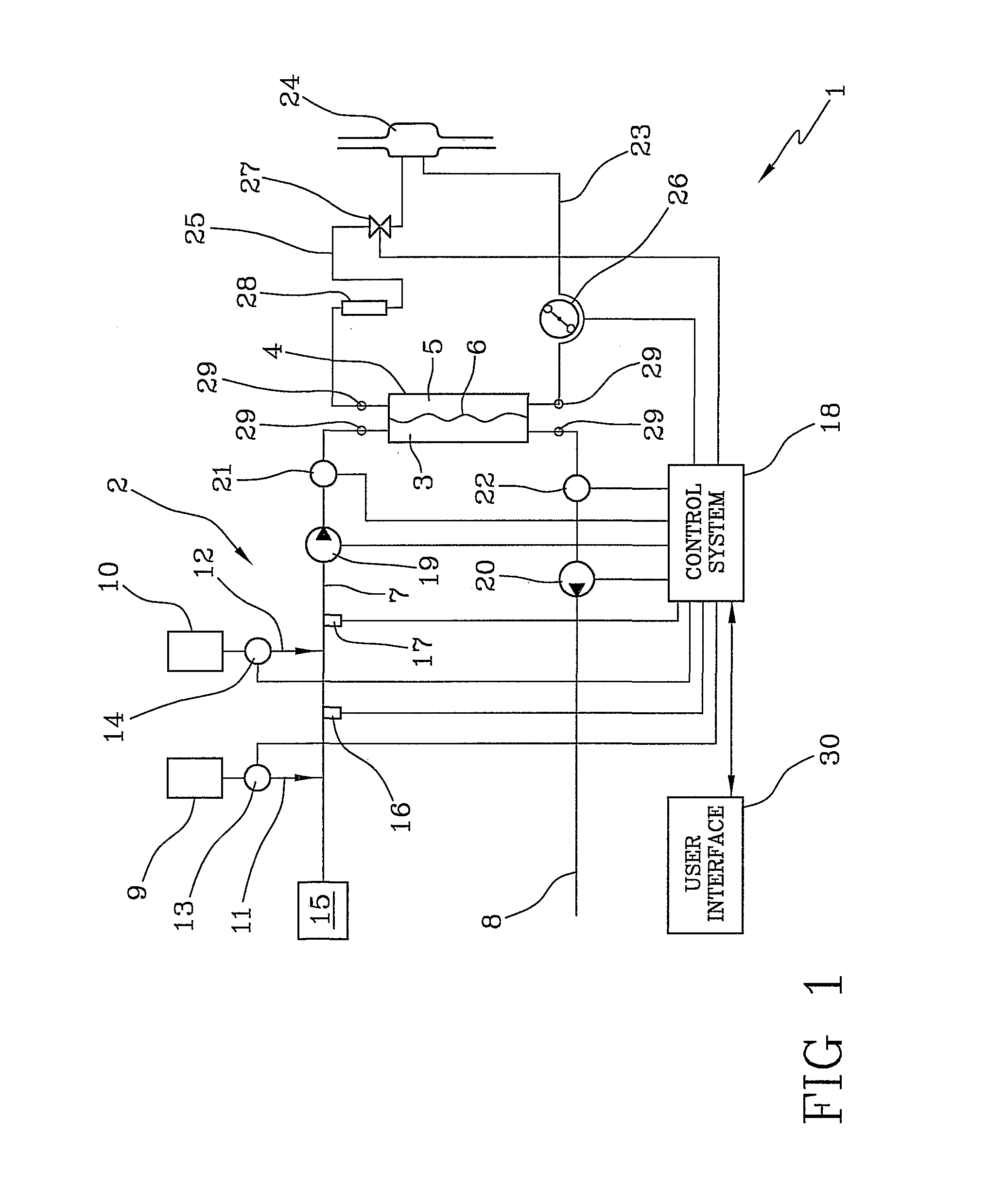

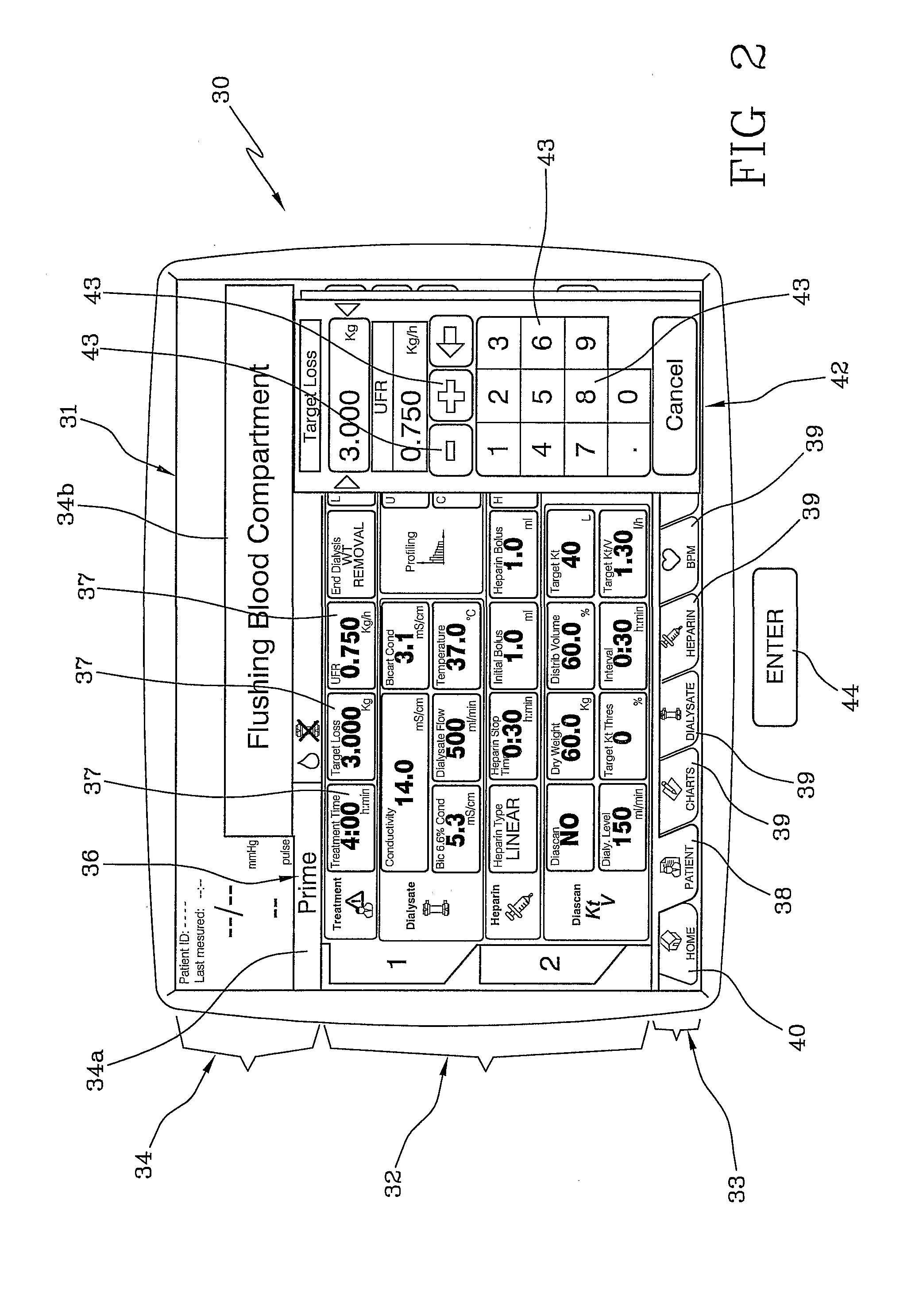

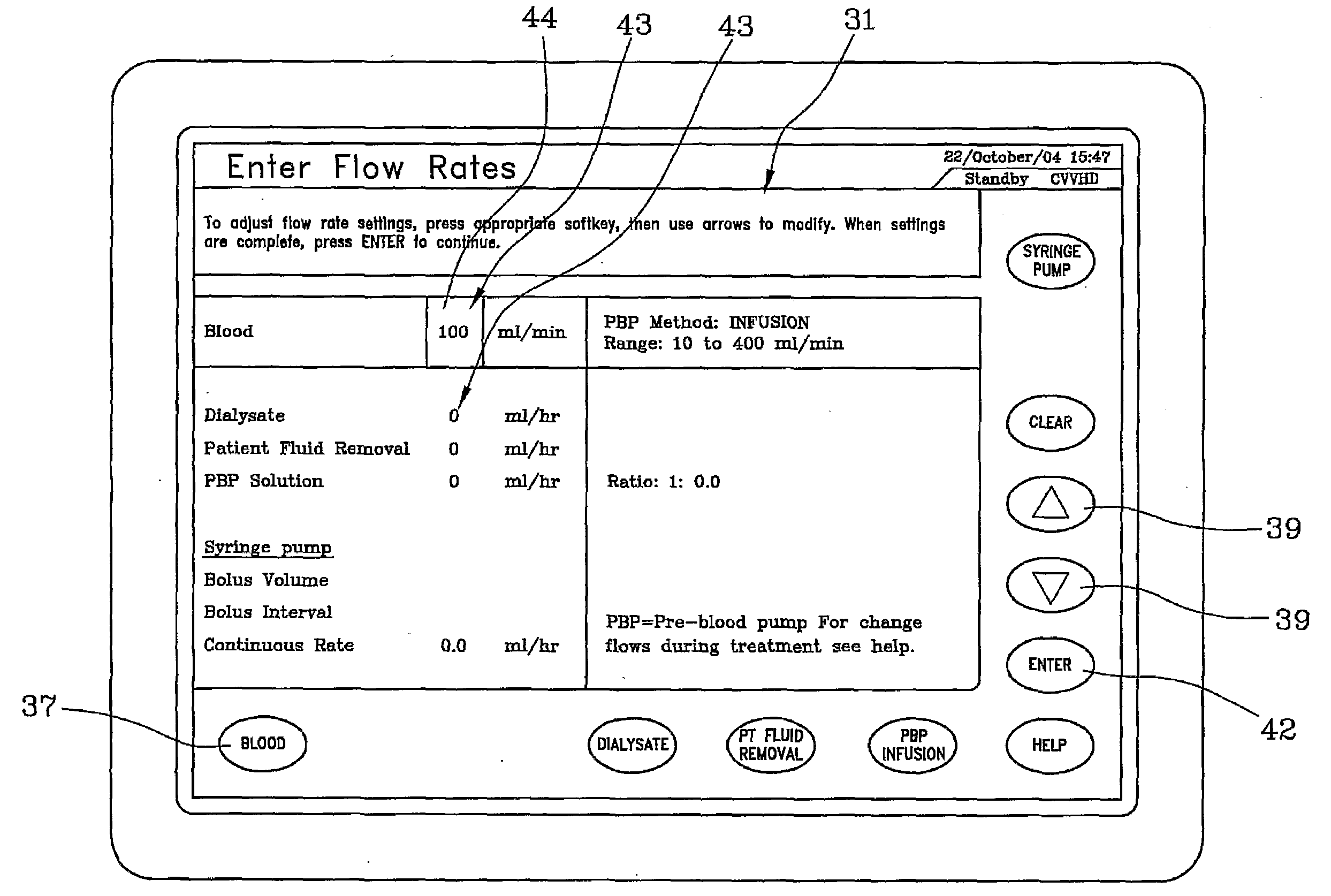

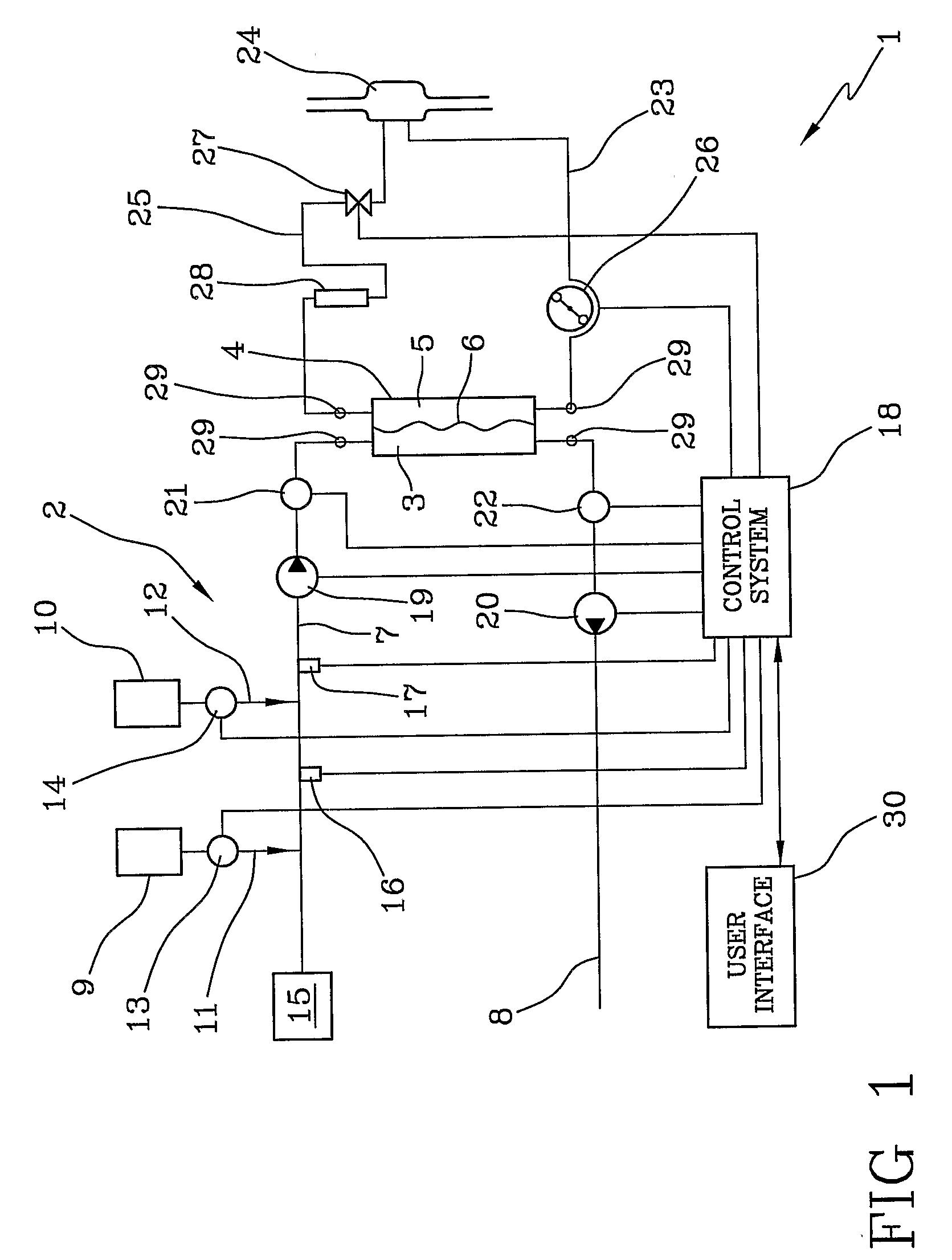

Medical Apparatus

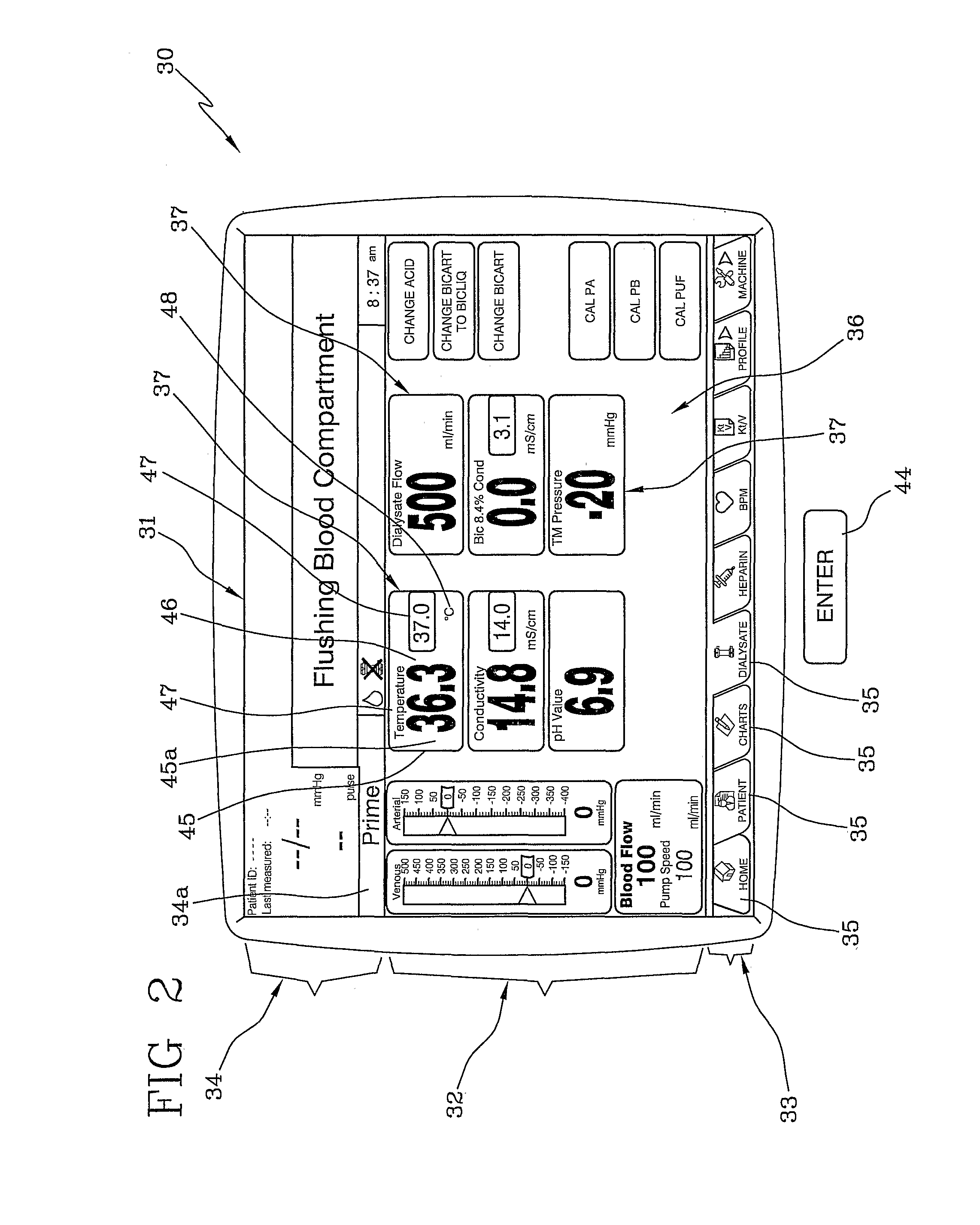

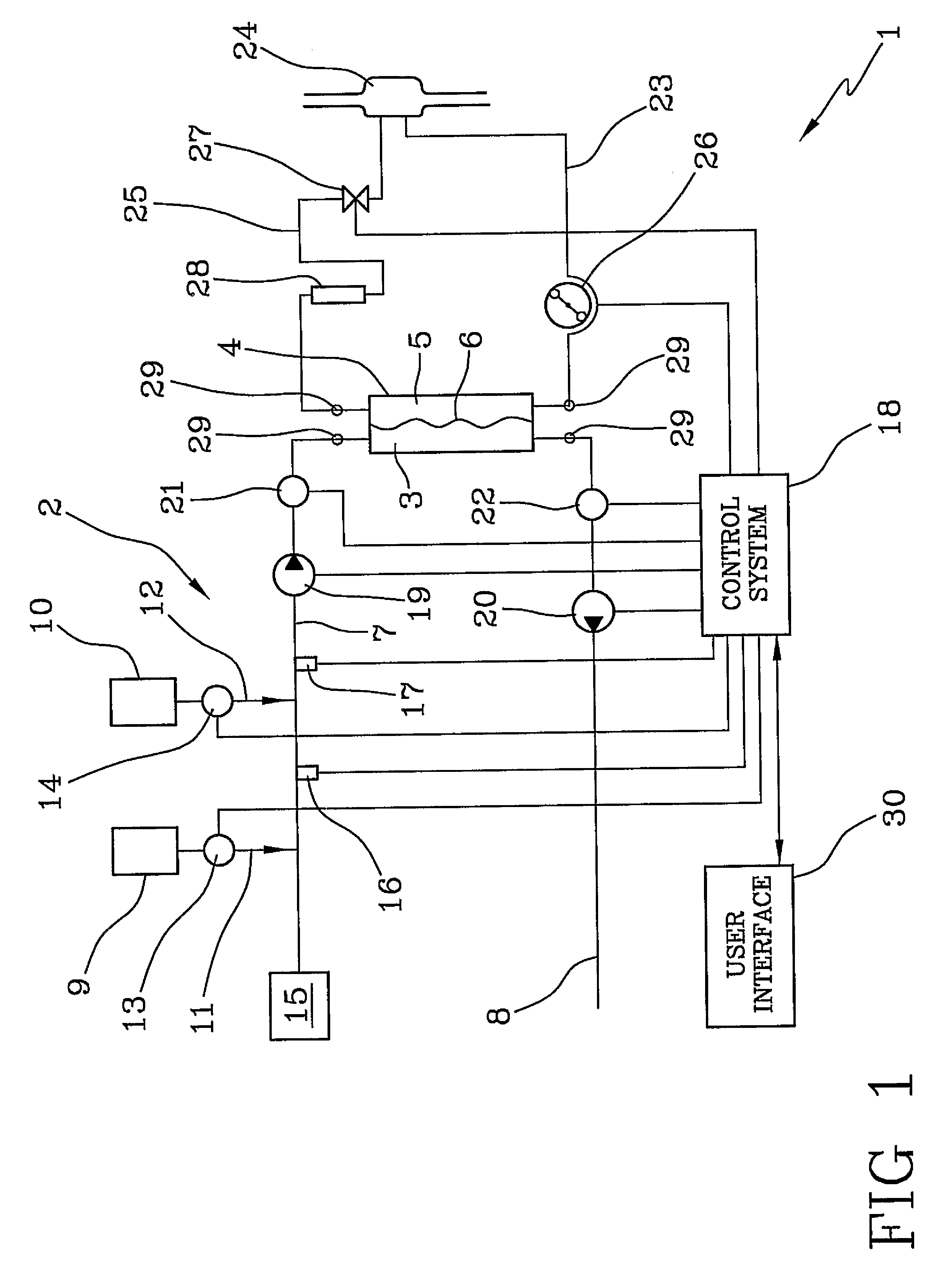

ActiveUS20080249377A1Improve ease and reliability in data entryReduce data entryLocal control/monitoringComputer controlControl systemComputer science

A medical apparatus (1) comprises a user interface (30), a number of sensors (16,27,21,22,29) and a control system (18) programmed for displaying on the user interface screen (31) a number of indicia (37), each relating to a corresponding parameter and comprising an indicium border (45) delimiting an indicium selection area (45a); the control system allows selection of an indicium for identifying the parameter a user intends to modify, allows setting of a new set value for the selected parameter; the control system also receives from the sensors (29) a measure of the actual value for the parameter and displays on the indicium selection area (45a) of the indicium both the actual value and the set value for the same parameter. The programming software for the control system is also disclosed.

Owner:GAMBRO LUNDIA AB

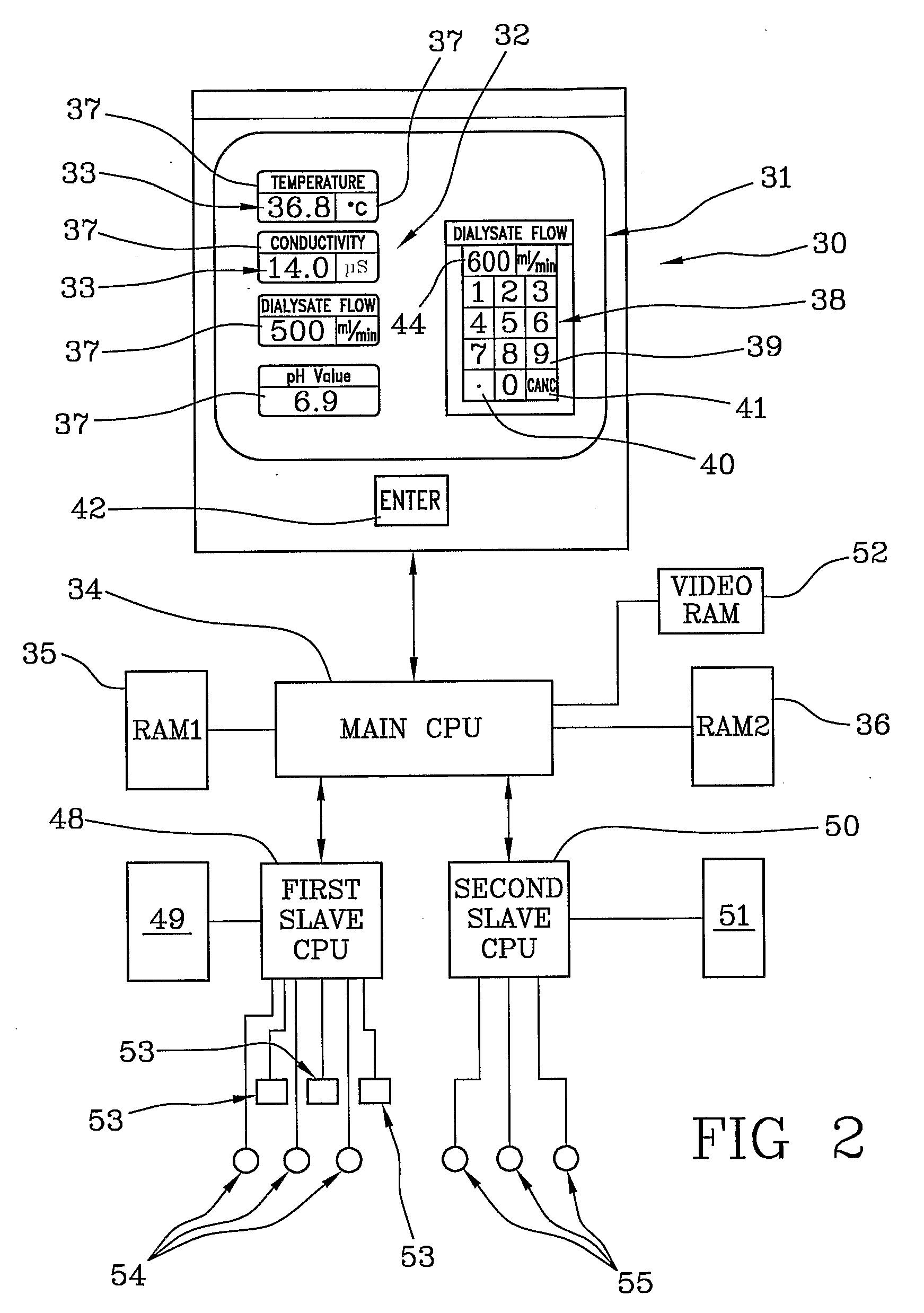

Medical apparatus and method for setting up a medical apparatus

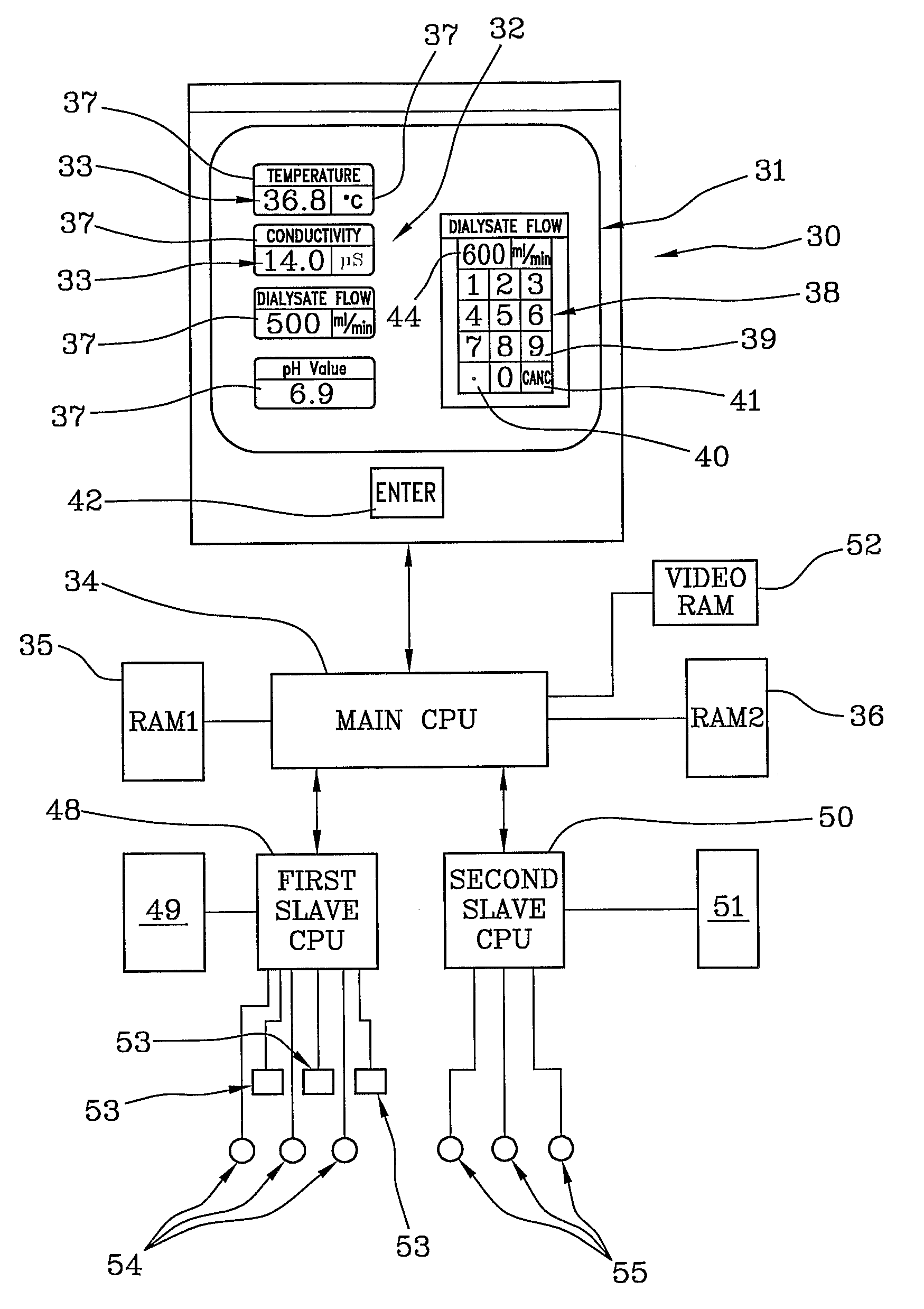

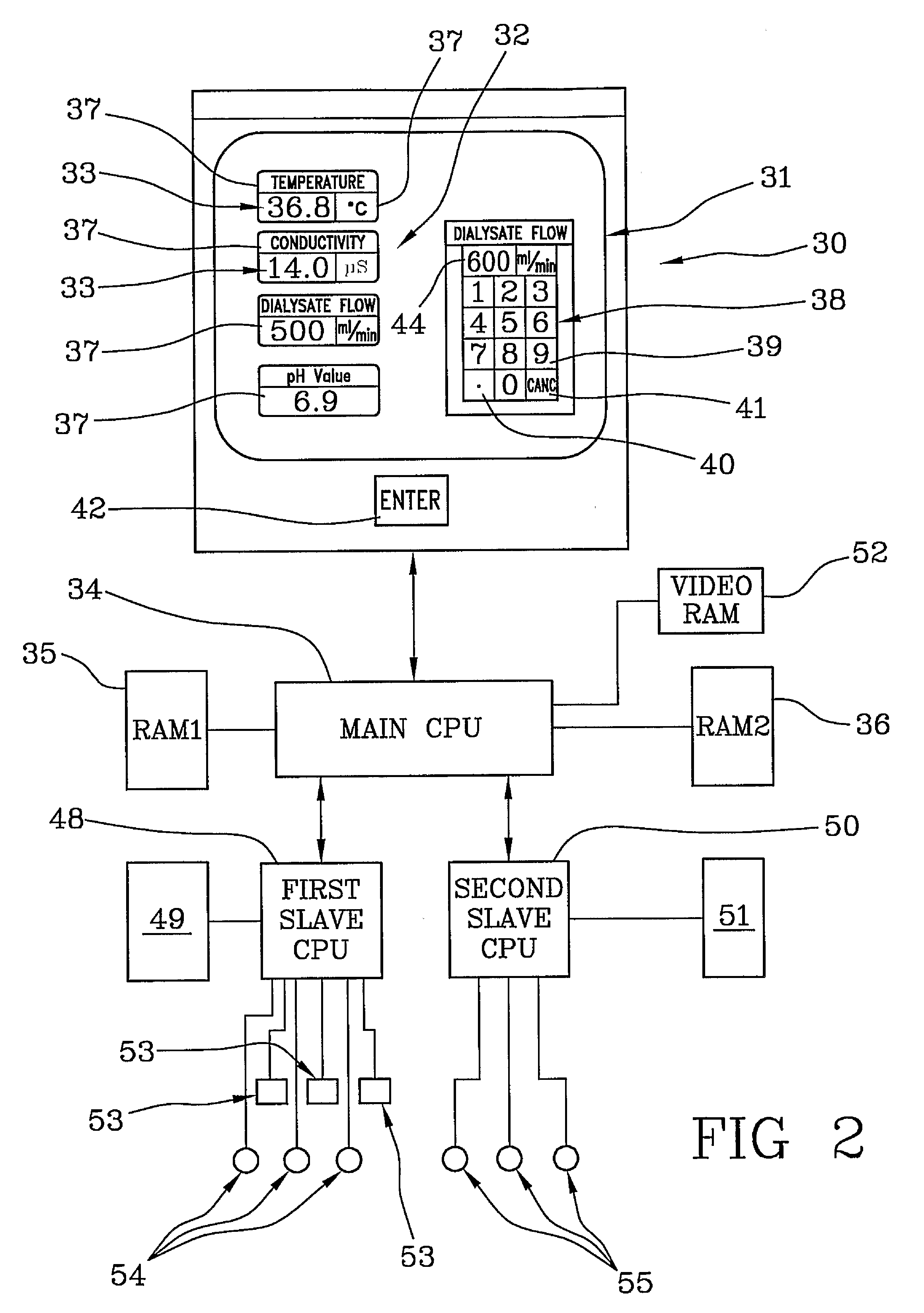

ActiveUS7922899B2Improve ease and reliabilityReduce data entryLiquid separation auxillary apparatusSolvent extractionData validationVideo memory

A medical apparatus comprises a user interface for setting parameters and includes: a screen for visualizing values of said parameters, a main control unit connected to the interface, a first memory and a video memory both connected to the main control unit for storing data corresponding to images on screen; the main control unit allows setting of a new value for a parameter, displays the new value on a screen region, stores the new value in the first memory, captures from the video memory data representative of said screen region, verifies from said representative data if the displayed value corresponds to the value in the first memory. A method for setting up a medical apparatus is also disclosed.

Owner:GAMBRO LUNDIA AB

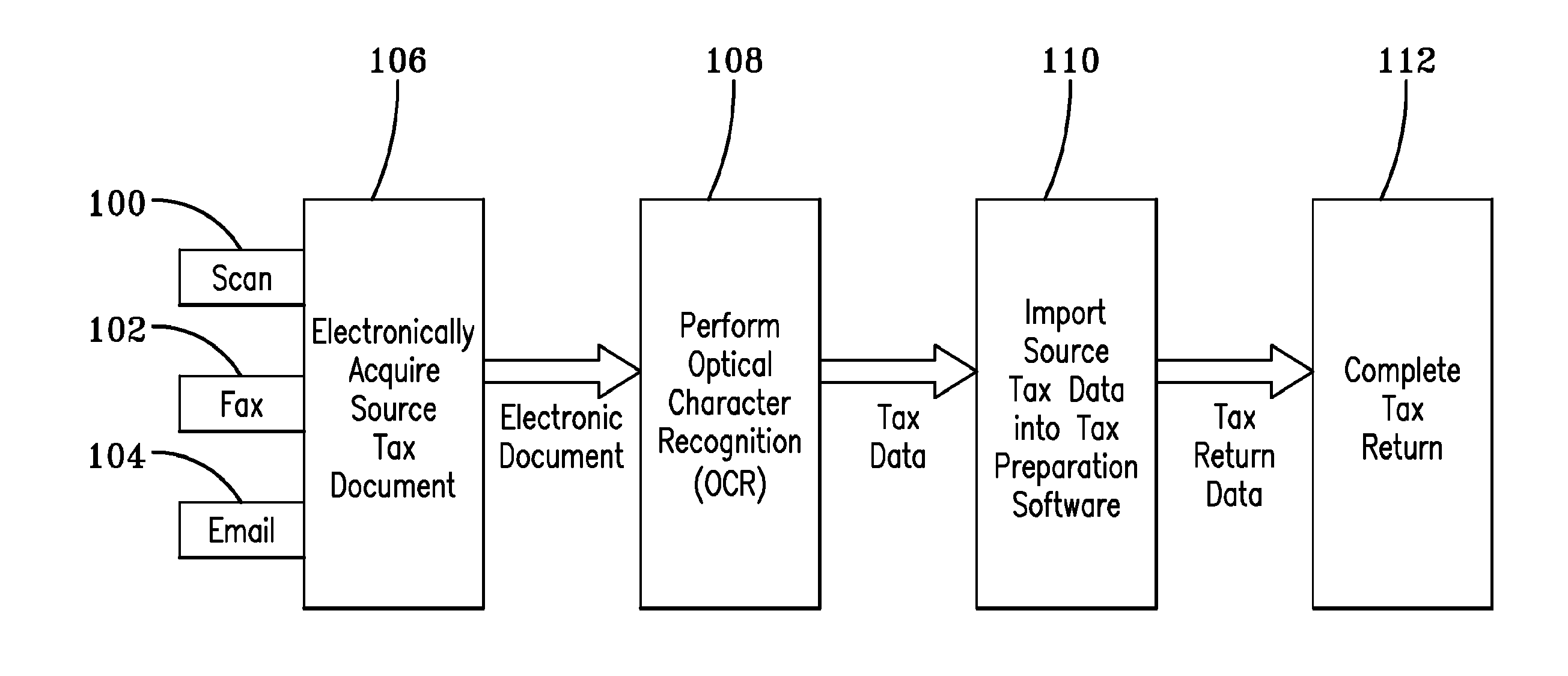

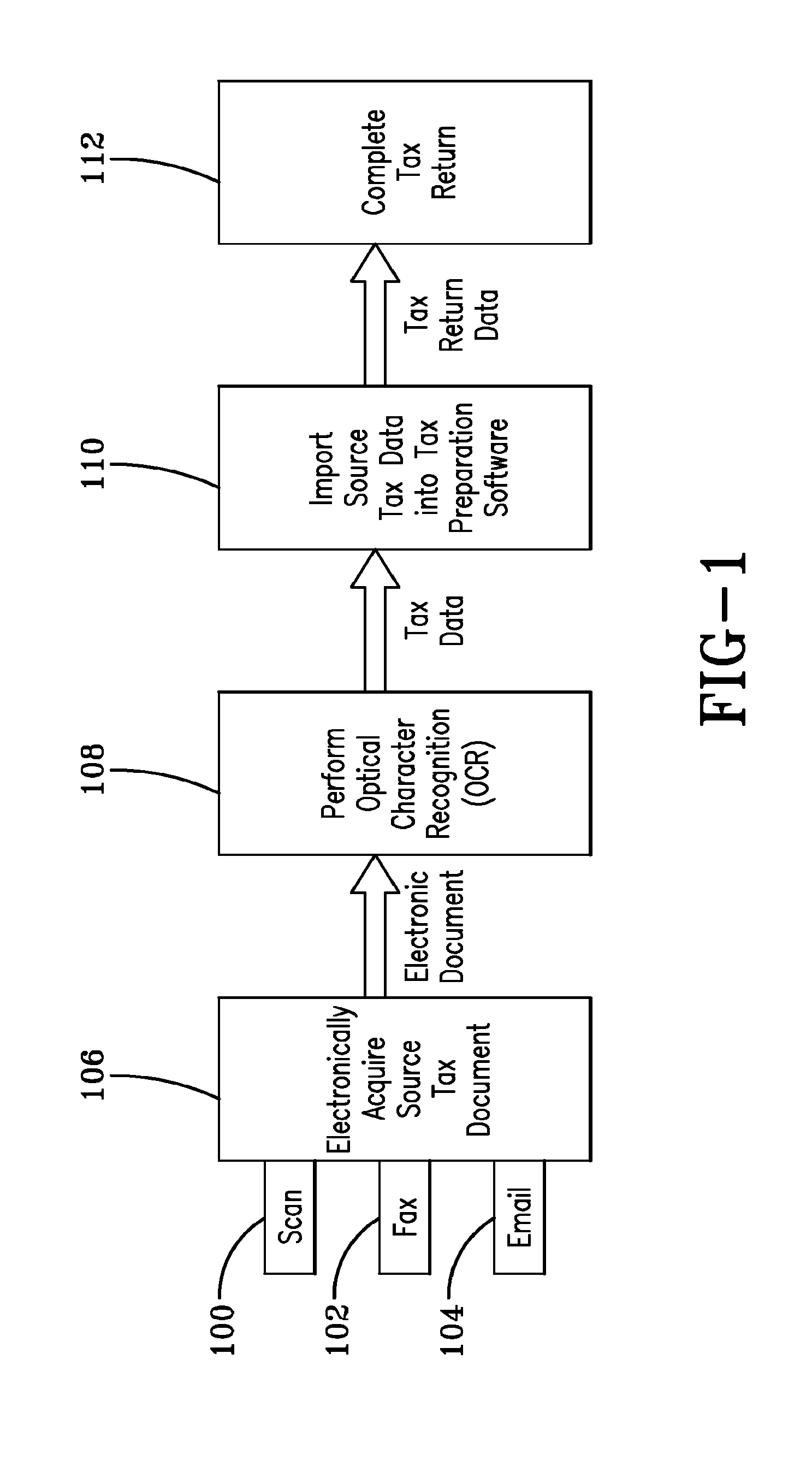

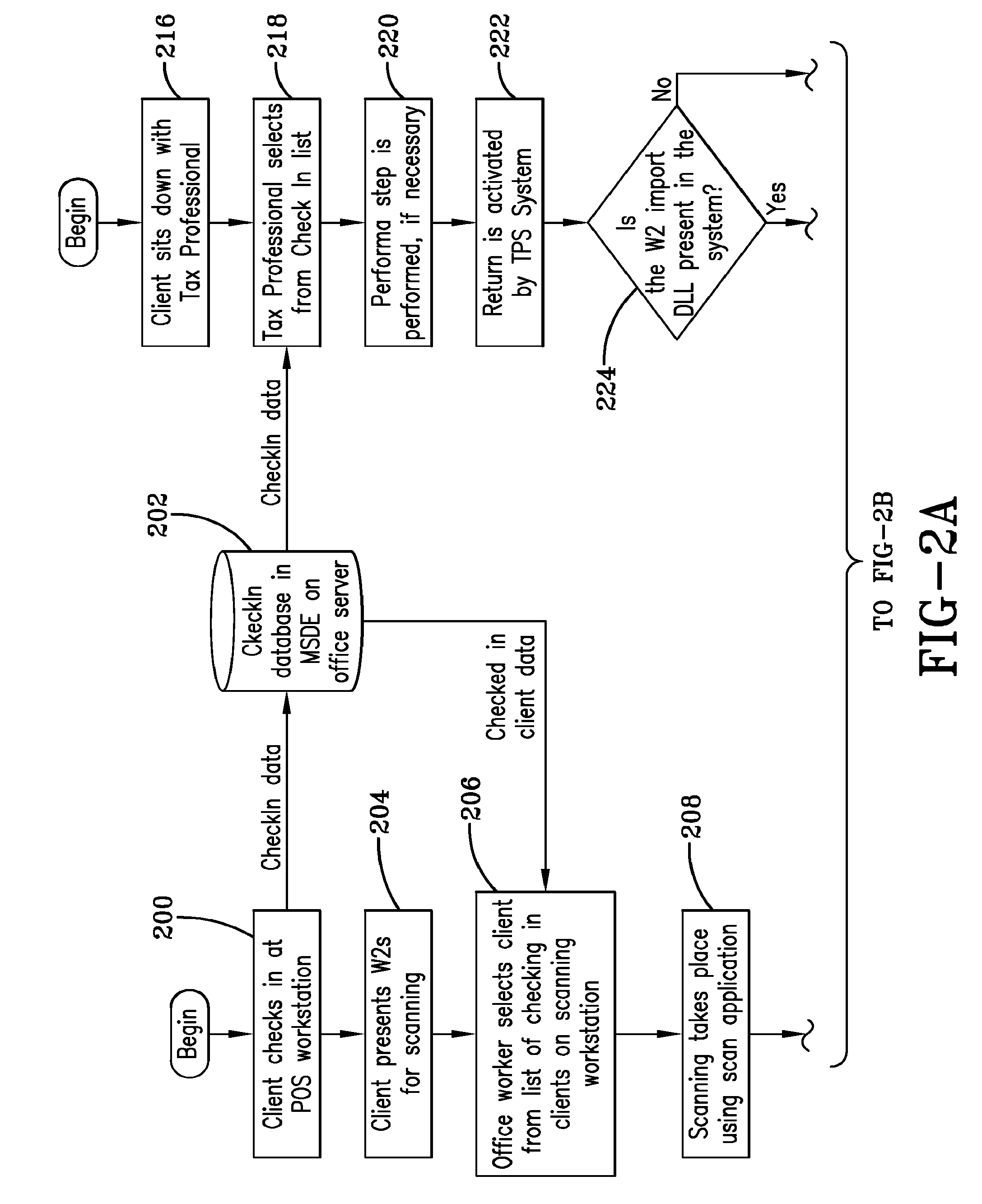

System and method for acquiring tax data for use in tax preparation software

InactiveUS20140172656A1Easy to operateMany timesComplete banking machinesFinanceElectronic formData acquisition

An automated system and method for acquiring tax data and importing it into tax preparation software. Tax documents are acquired electronically in a tax data acquisition process by scanning, faxing, or emailing them. Once a tax document is in electronic form, an optical character recognition (OCR) software process obtains tax data from the electronic tax document. Each piece of tax data that is obtained from the OCR software process is then imported into tax preparation software. Once the tax data has been imported into tax preparation software, the software may be used to complete a tax return. An important step in the tax return preparation process is automated so the need for tax professionals to spend time entering tax data into tax preparation software is reduced and data entry errors are reduced. Tax professionals may devote more time to preparing tax returns and less time to data entry.

Owner:HRB TAX GROUP

Medical apparatus

ActiveUS8075509B2Improve ease and reliability in data entryReduce data entrySemi-permeable membranesSolvent extractionControl systemMedical device

A medical apparatus (1) comprises a user interface (30), a number of sensors (16,27,21,22,29) and a control system (18) programmed for displaying on the user interface screen (31) a number of indicia (37), each relating to a corresponding parameter and comprising an indicium border (45) delimiting an indicium selection area (45a); the control system allows selection of an indicium for identifying the parameter a user intends to modify, allows setting of a new set value for the selected parameter; the control system also receives from the sensors (29) a measure of the actual value for the parameter and displays on the indicium selection area (45a) of the indicium both the actual value and the set value for the same parameter. The programming software for the control system is also disclosed.

Owner:GAMBRO LUNDIA AB

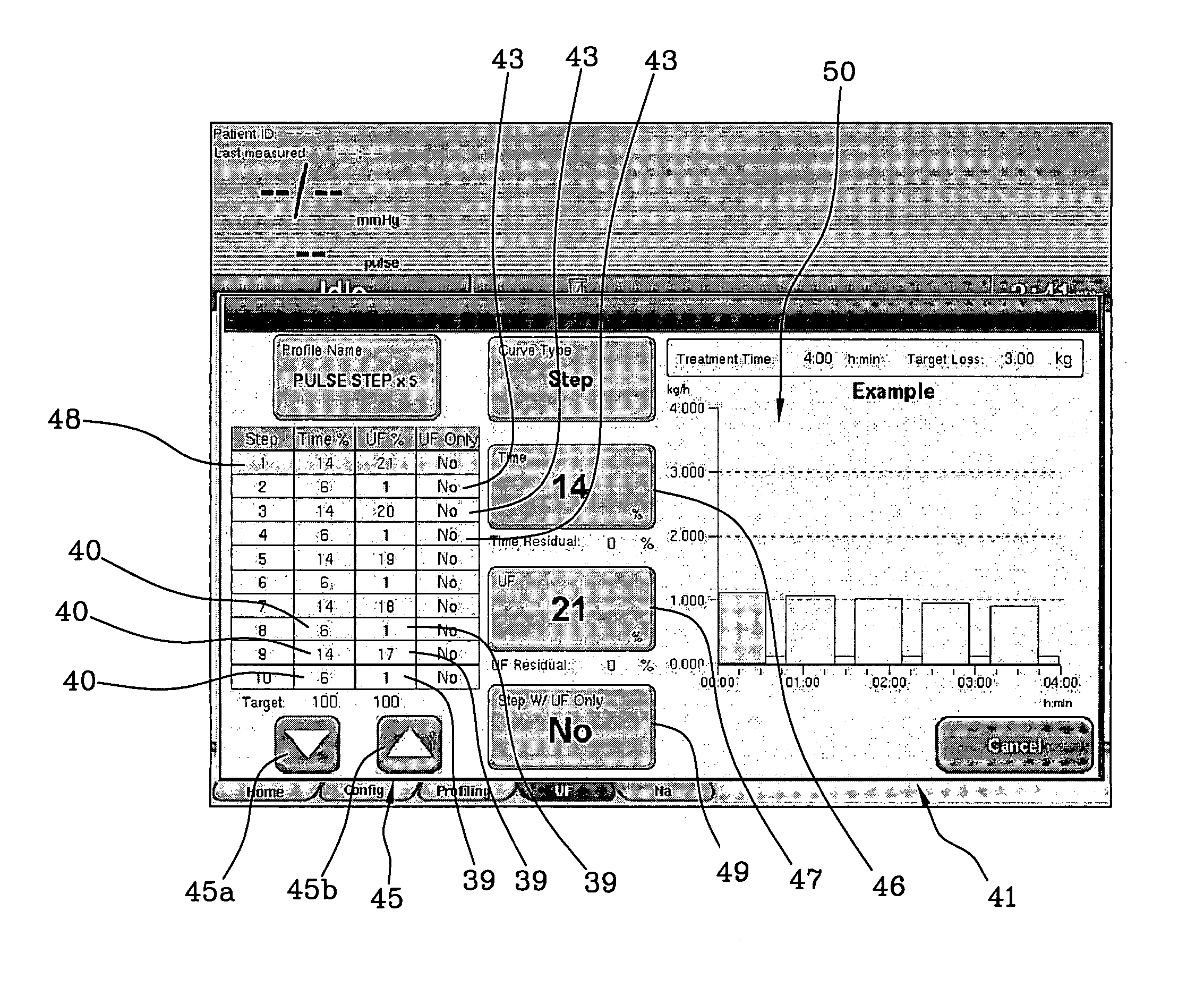

Medical apparatus with improved user interface

ActiveUS7988850B2Improve ease and reliability in data entryReduce data entryMechanical/radiation/invasive therapiesDialysis systemsMedical equipmentTime profile

A medical apparatus comprises a control system allowing storage of a number of shaping profiles. Each shaping profile is stored as a plurality of pairs, including a shaping profile reference value and a time interval value. The reference value is represented as fraction, for instance a percentage, of the total weight loss the apparatus should achieve at the end of a treatment time. Each time interval value is represented either as fraction of the total treatment time or as a prefixed actual time interval. The control system calculates the actual weight loss rate versus time profile based on the desired total weight loss, on the desired total treatment time as well as on selected desired shaping profile.

Owner:GAMBRO LUNDIA AB

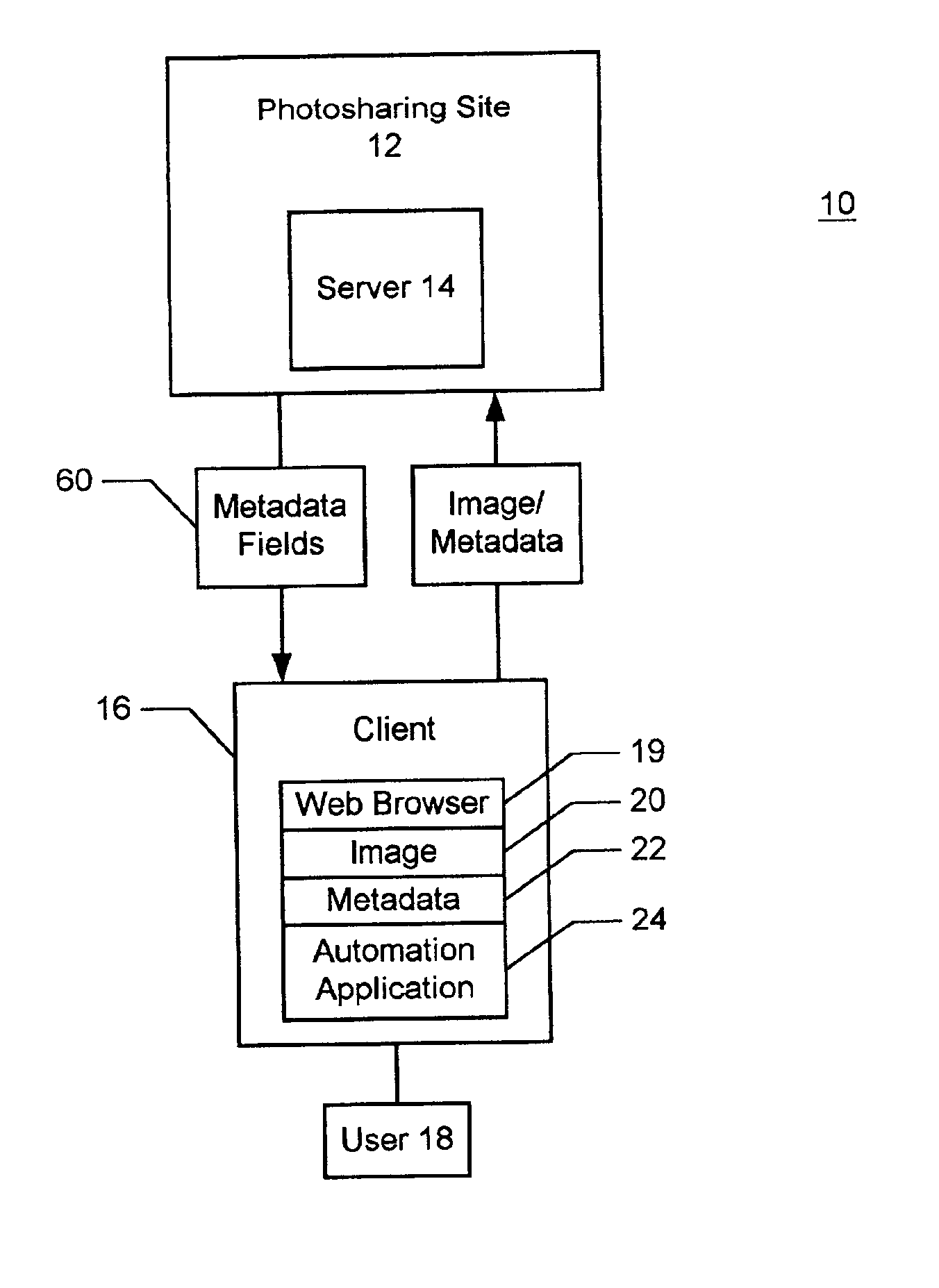

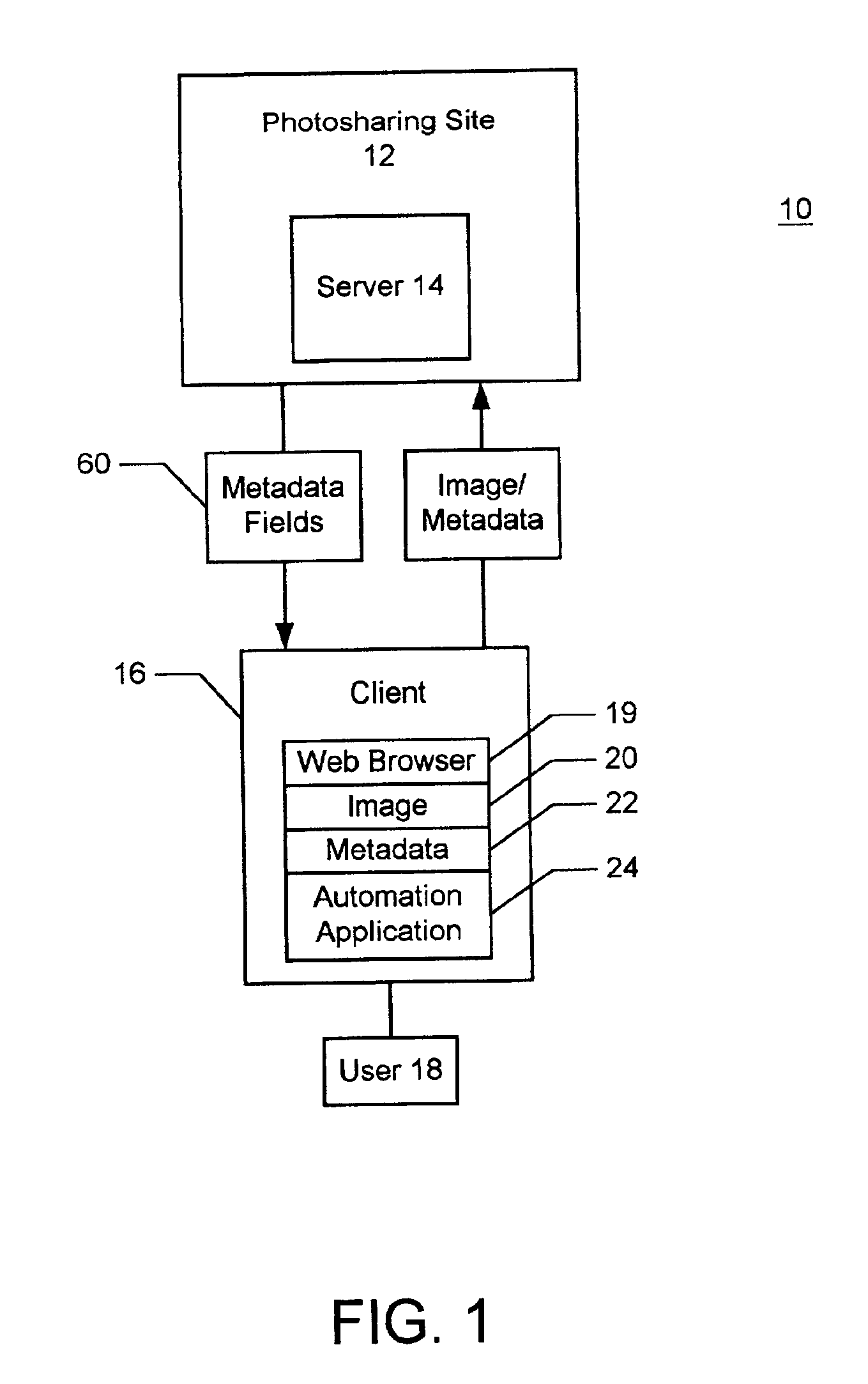

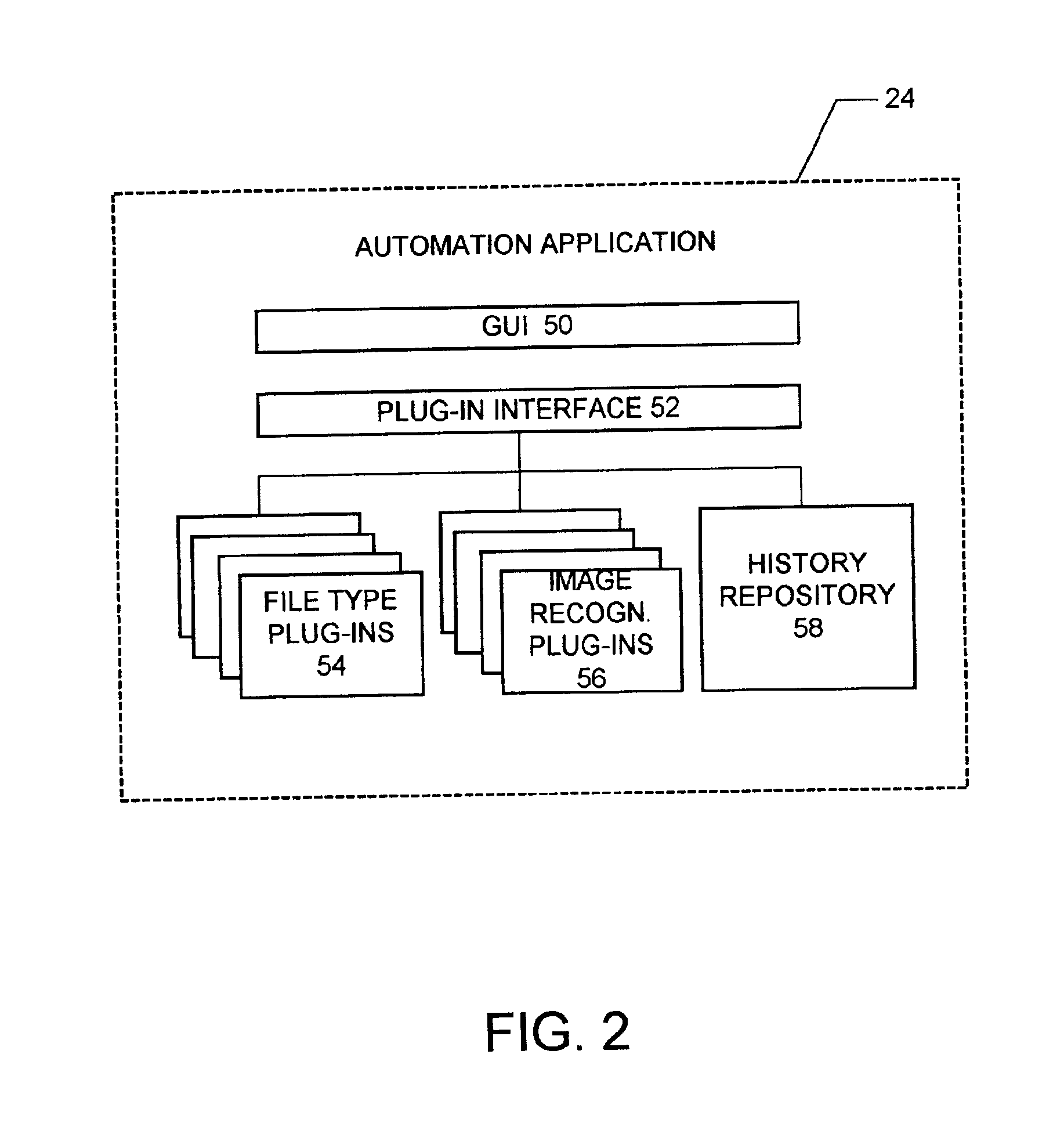

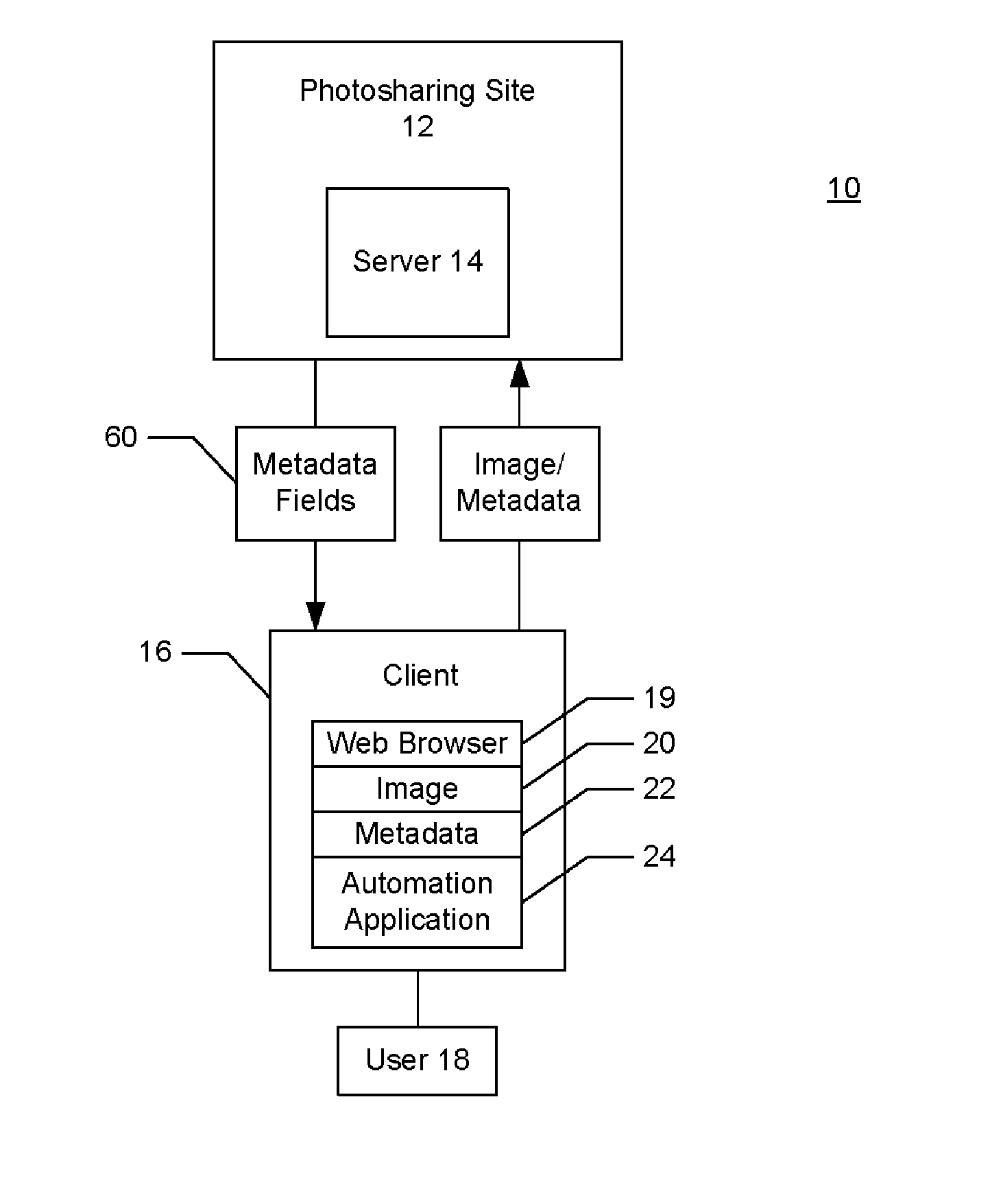

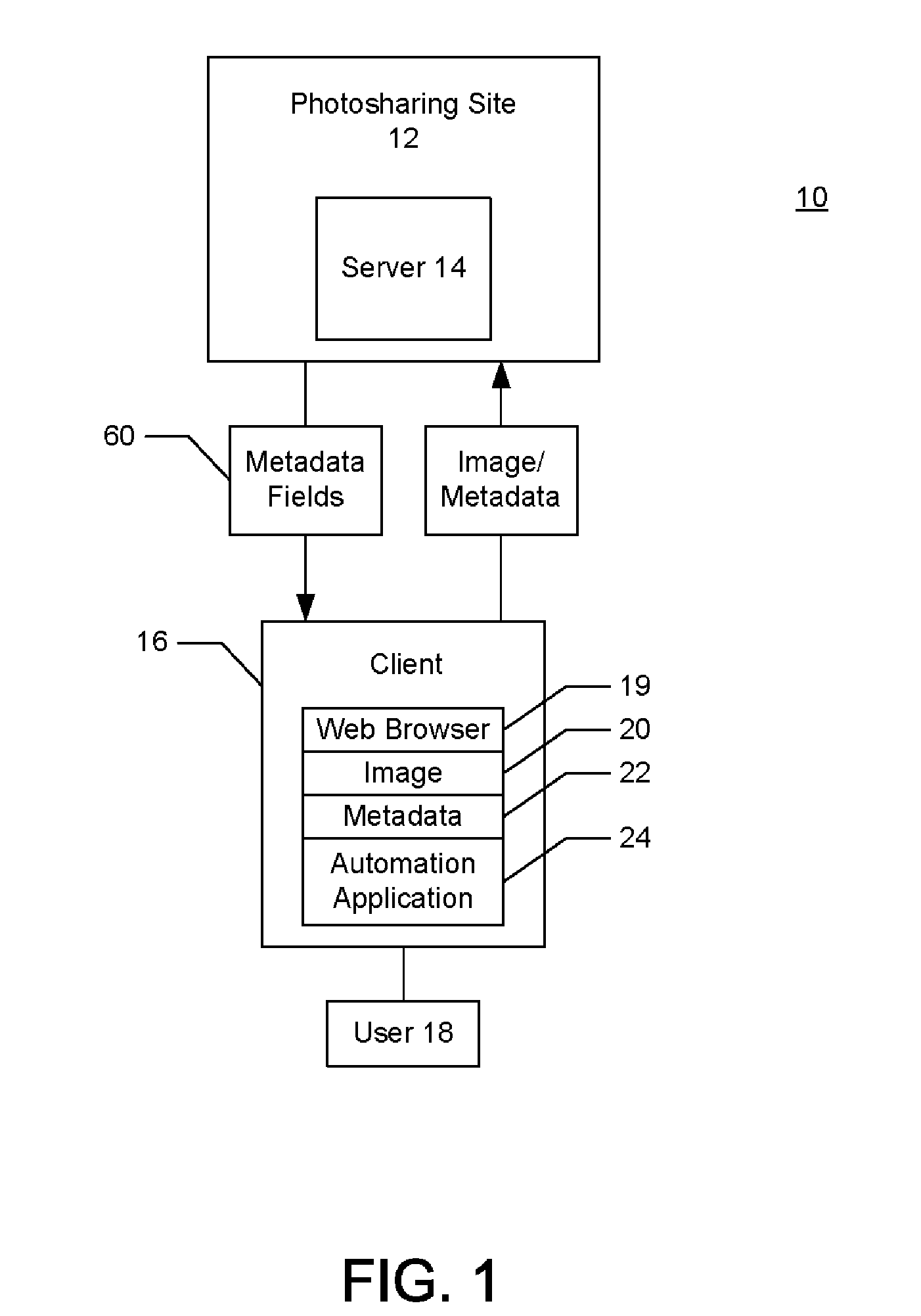

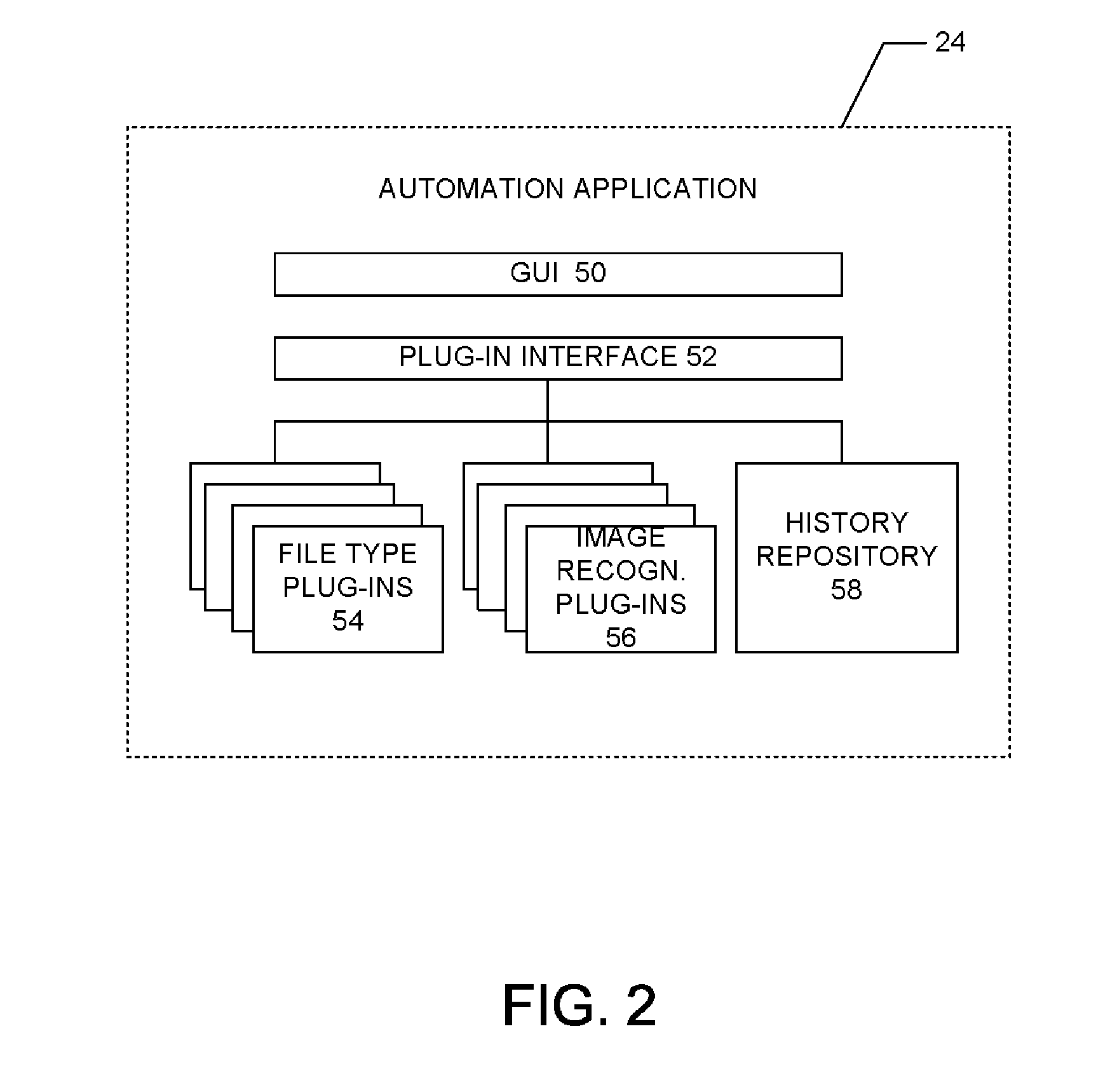

Automated discovery, assignment, and submission of image metadata to a network-based photosharing service

InactiveUS6954543B2Reduce data entryData processing applicationsDigital data processing detailsMetadata discoveryImage sharing

An automated metadata discovery, assignment, and submission system is disclosed. The system includes a photosharing service coupled to a network through a server, where the server stores metadata fields. The system also includes at least one client computer capable of communicating with the server over the network, where the client computer stores a plurality digital files and an automation application. When executed, the automation application establishes communication with the photosharing service and downloads the metadata fields. The content of a first file is then automatically analyzed and one or metadata values are assigned to the downloaded metadata fields based on the analysis. In addition, the automation application automatically discovers any pre-existing metadata values associated with the file and uses the metadata values to populate corresponding downloaded metadata fields. Both the pre-existing and automatically assigned metadata values are then displayed to the user for viewing and editing. The metadata values assigned to the file are recoded for use with a next image, and the file and the metadata values are uploaded to the photosharing service for storage.

Owner:IPAC SUB

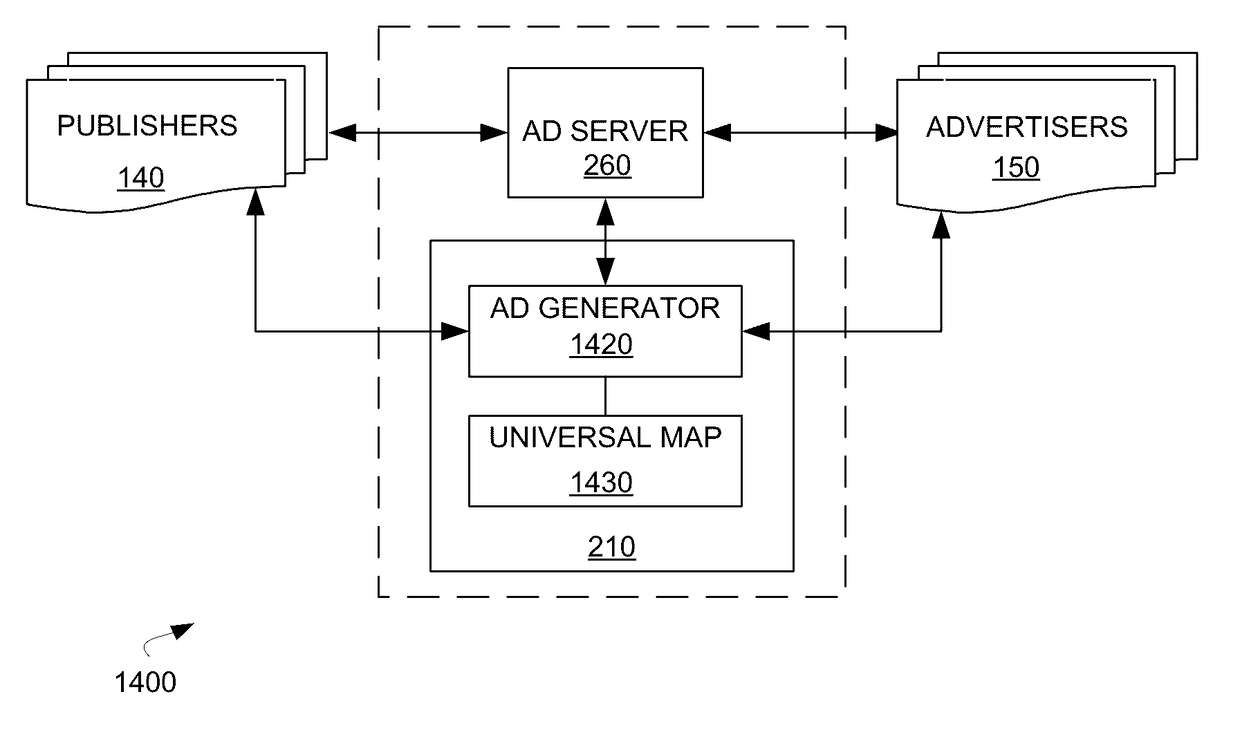

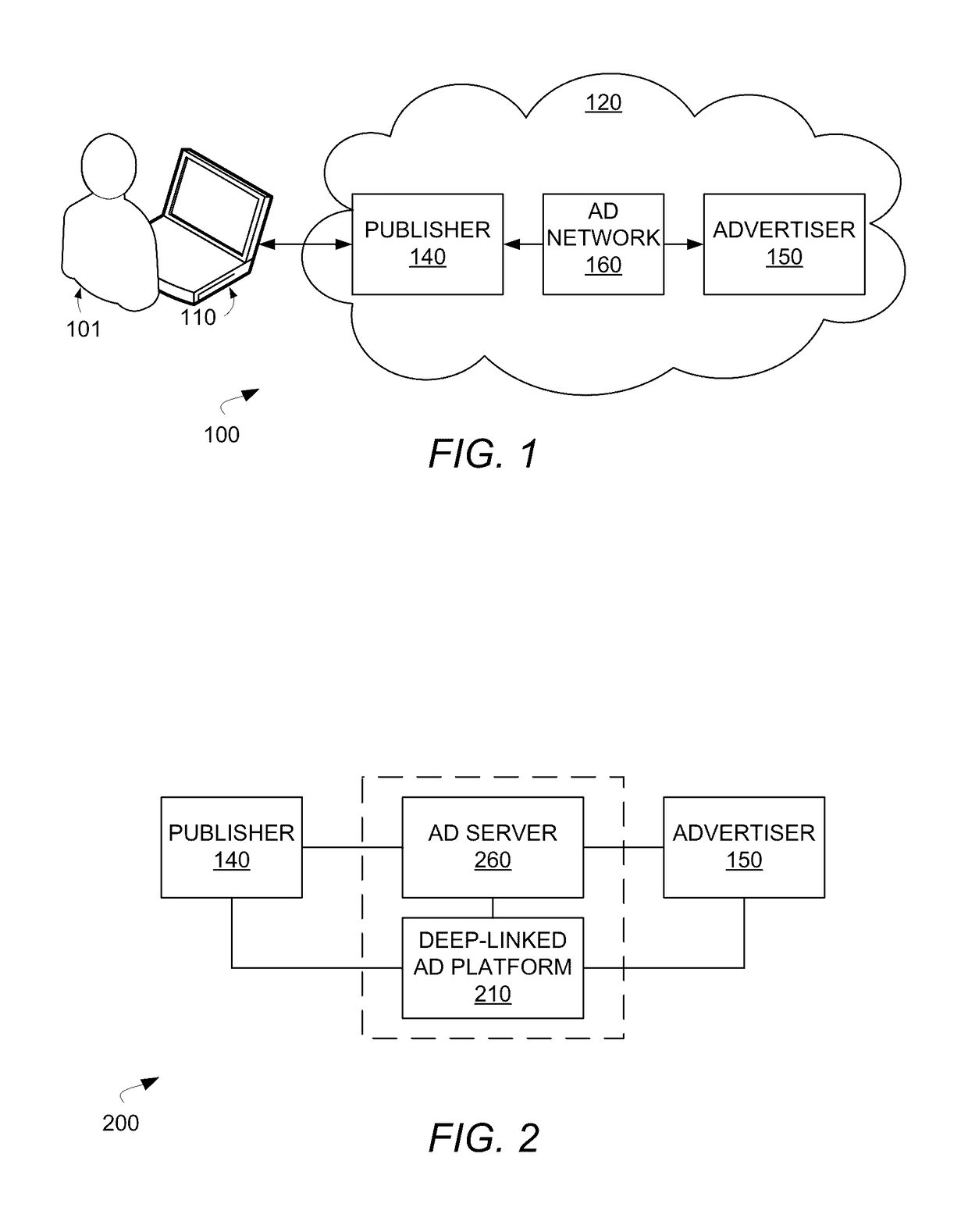

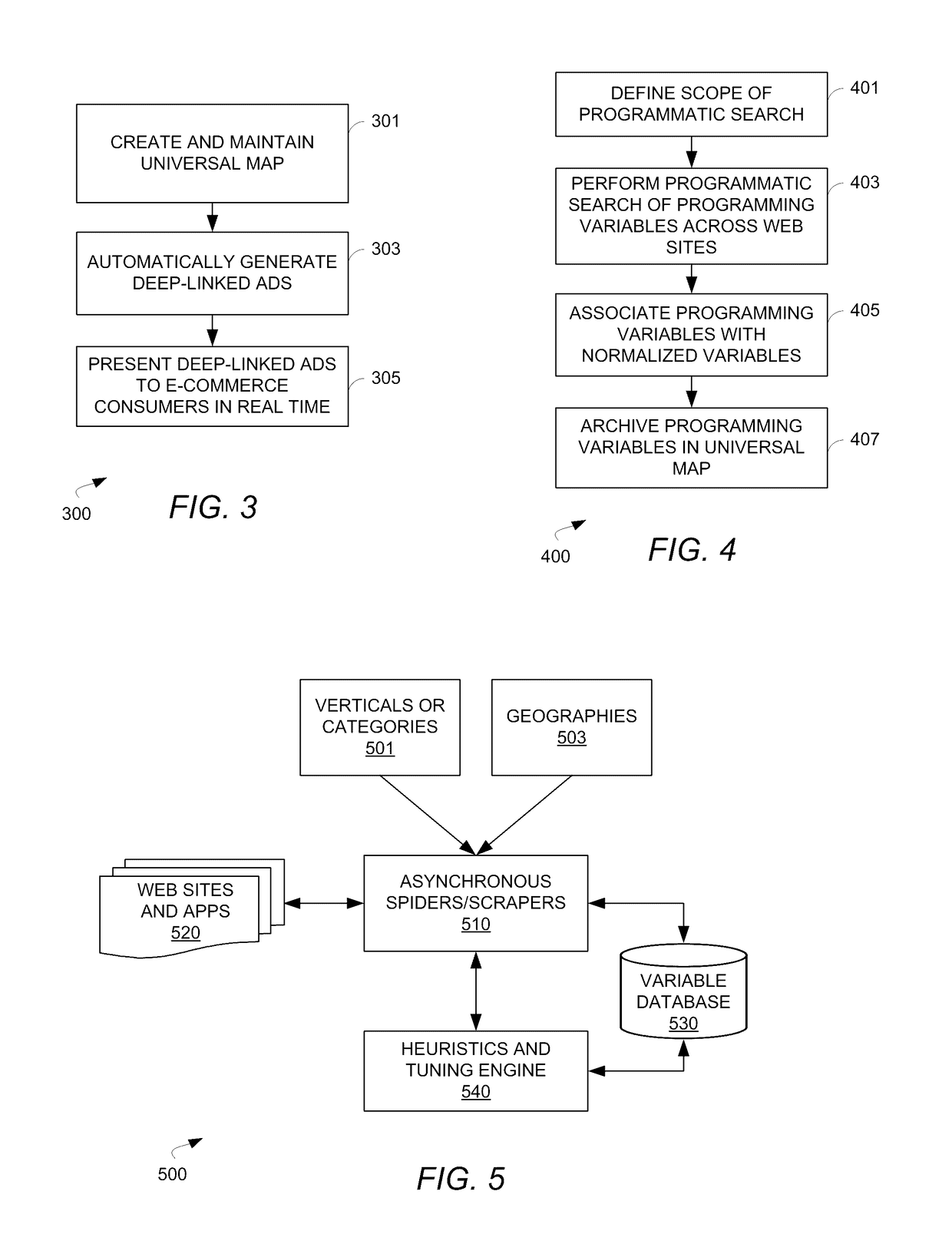

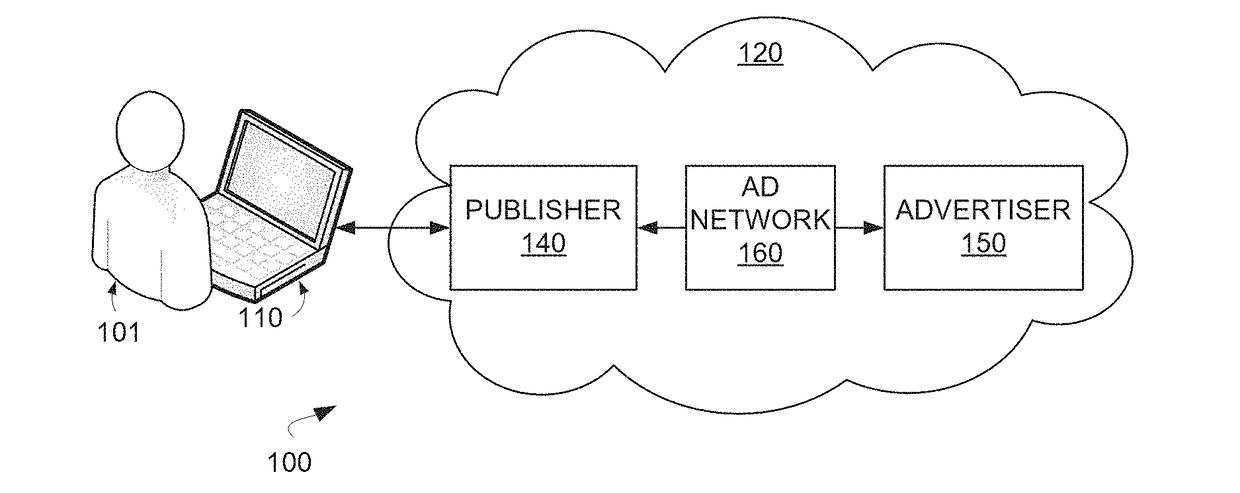

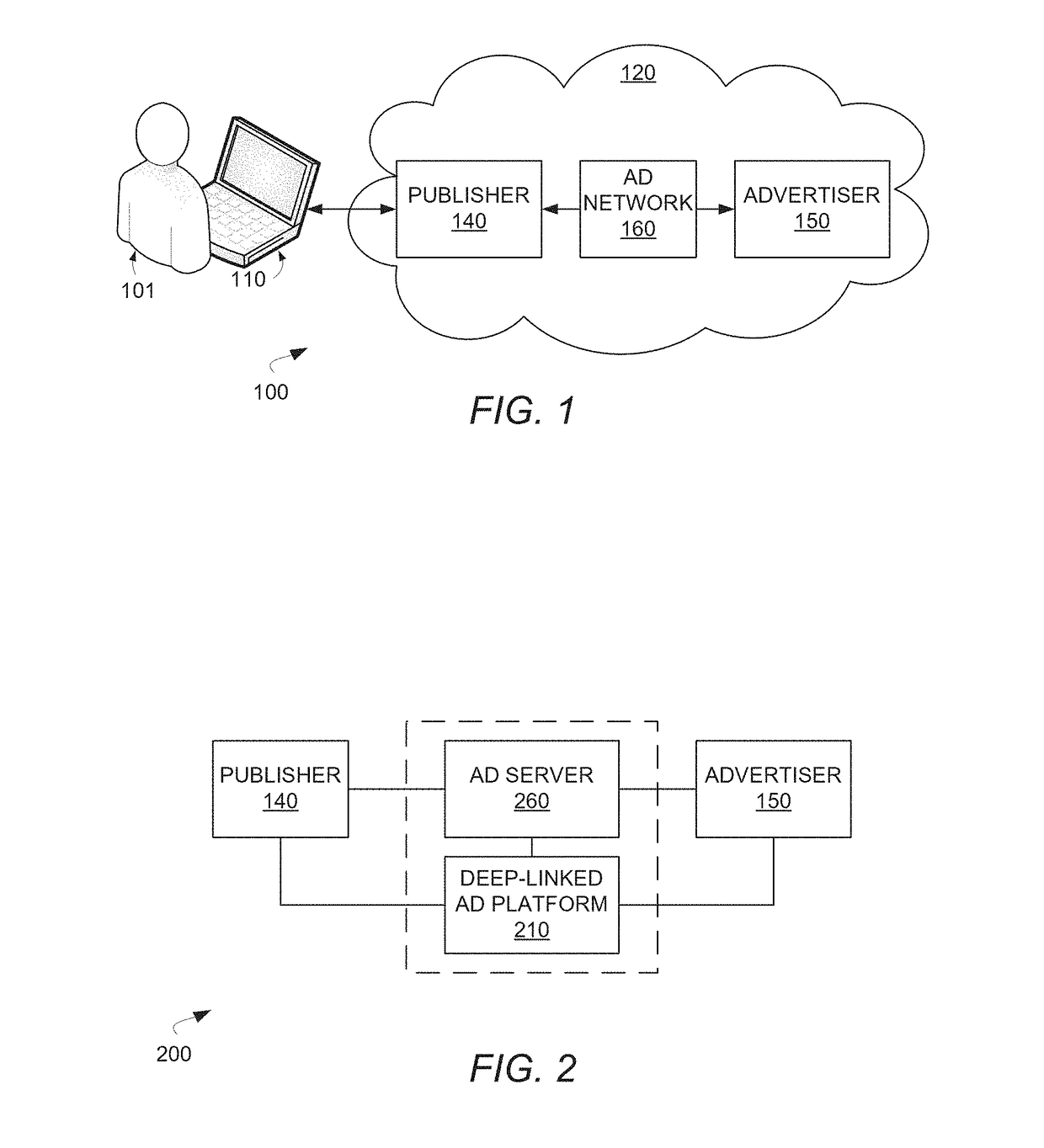

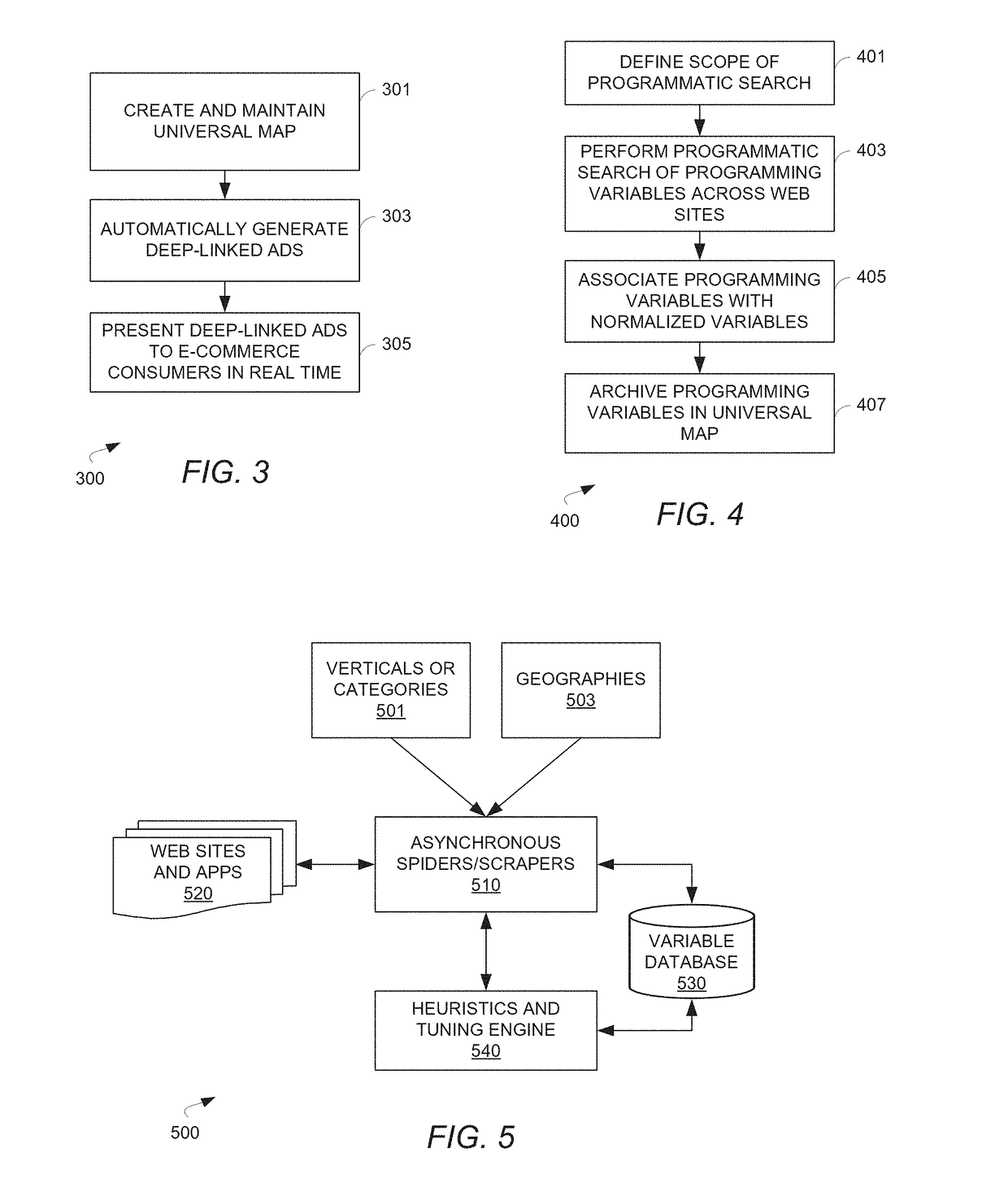

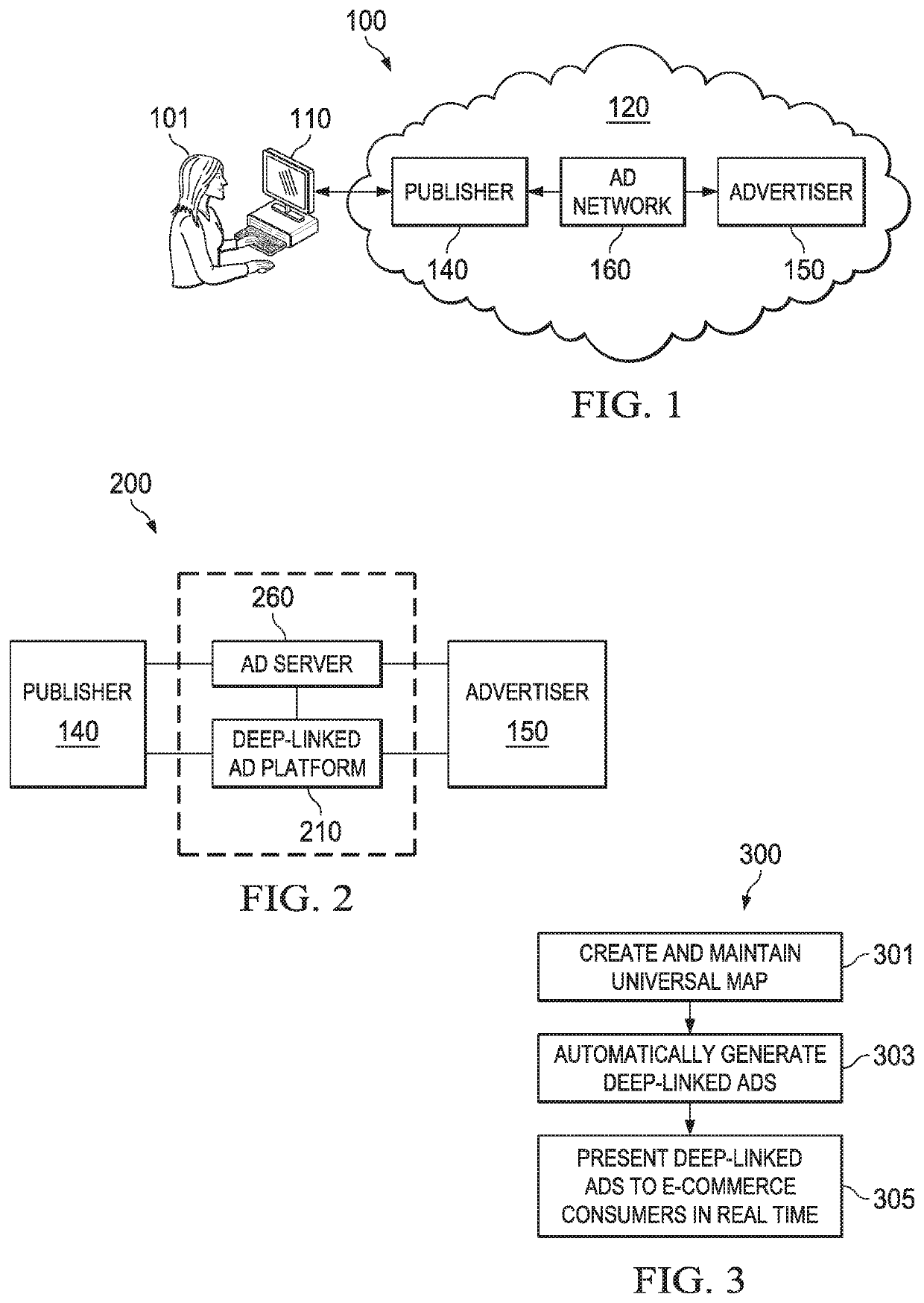

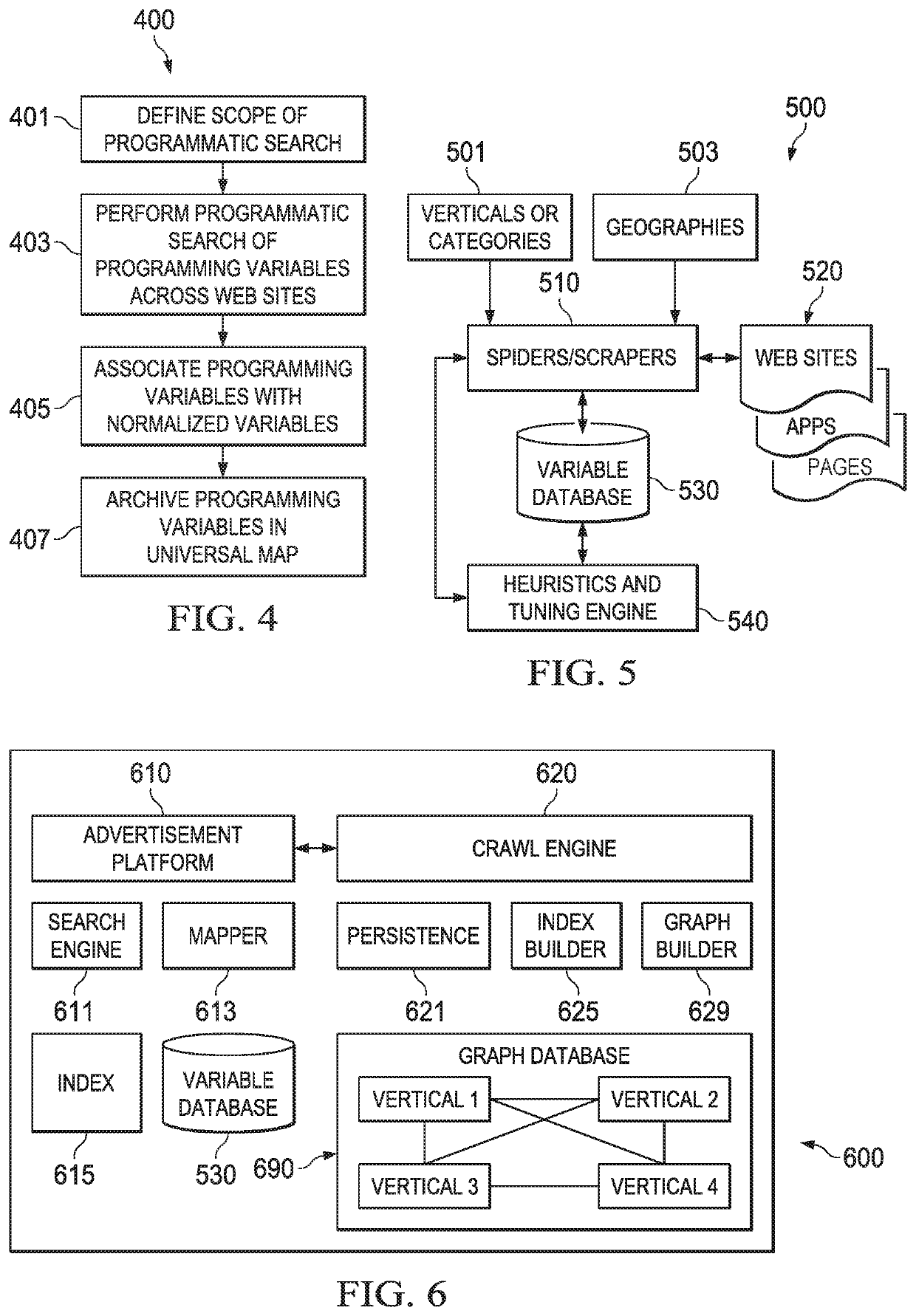

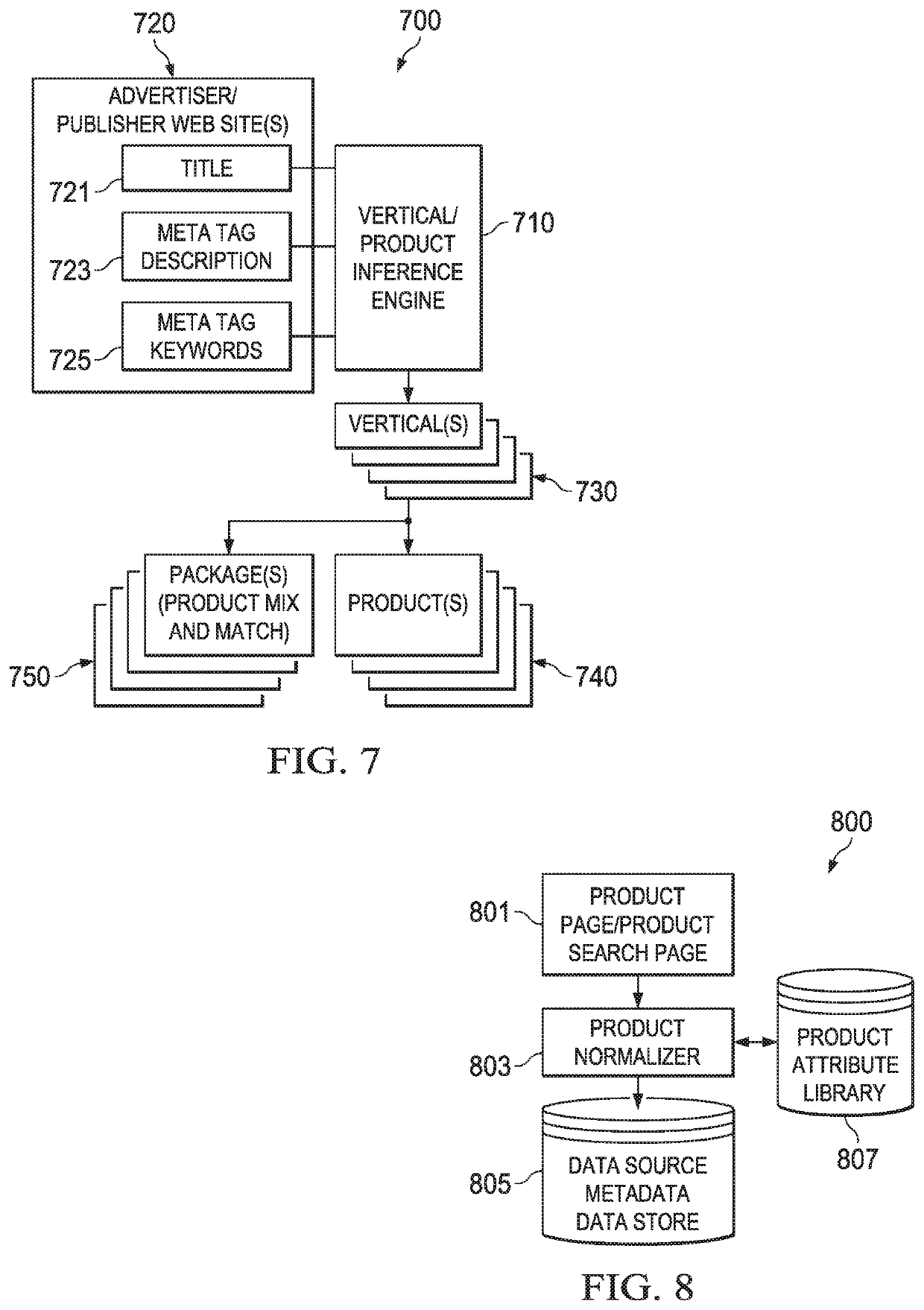

Deep-linking system, method and computer program product for online advertisement and E-commerce

Embodiments disclosed herein can leverage dynamic data, fields and implied information from arbitrary web sites, mobile apps and other forms of online media to create a universal variable map and automatically generate deep-linked ads utilizing the universal variable map, linking any arbitrary web site, mobile app, network, Internet TV channel, and other forms of online media to any other such arbitrary web site, mobile app, network, Internet TV channel, and other forms of online media. The automatically generated deep-linked ads can be inserted into any ad server and served out from there in real-time. A deep-linked ad thus presented to a user can take the user from a starting page on one site or application where the ad is displayed directly to a resulting page such as a checkout page on another site or mobile application, with pertinent information already pre-populated, and action already initiated for the user.

Owner:METARAIL INC

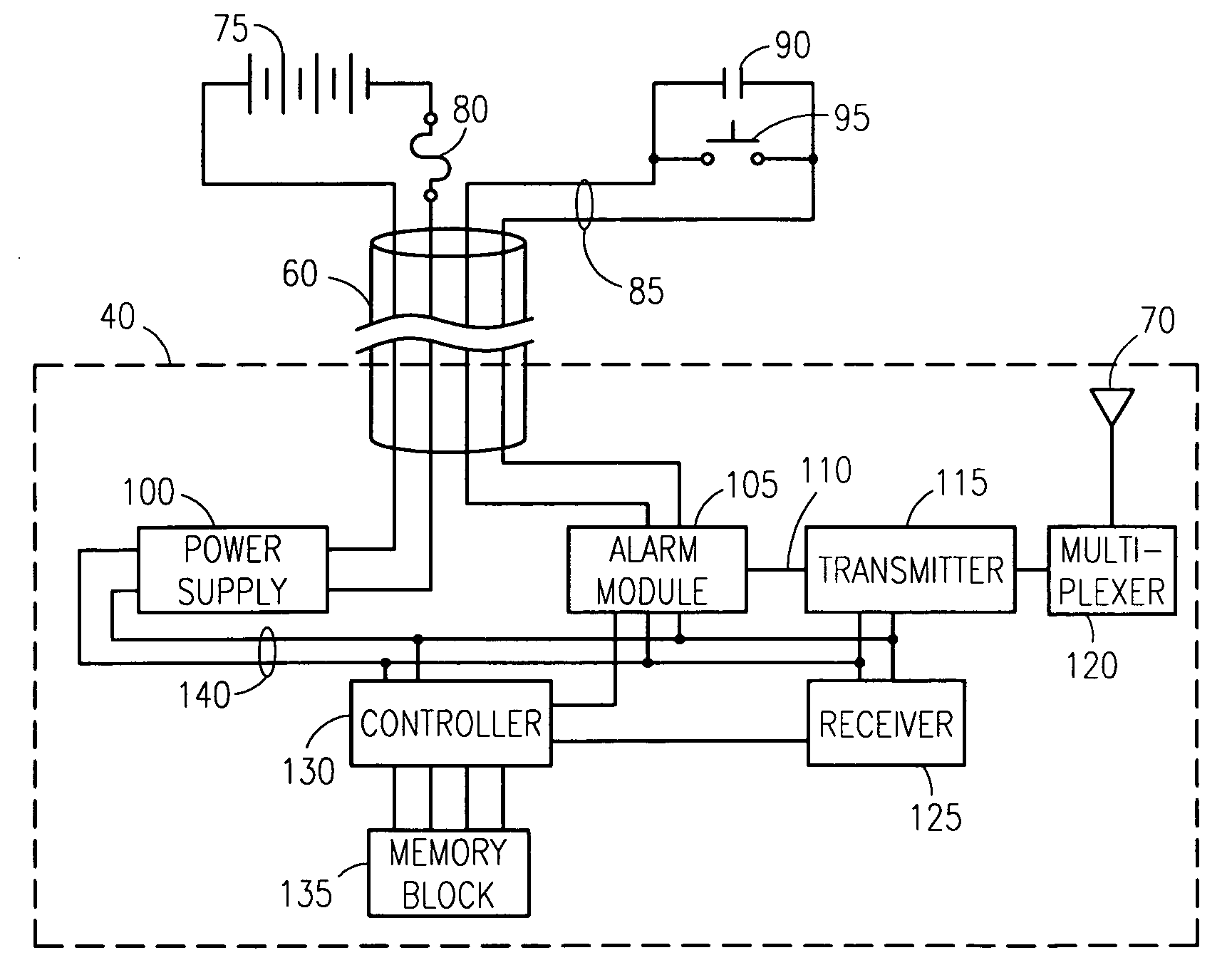

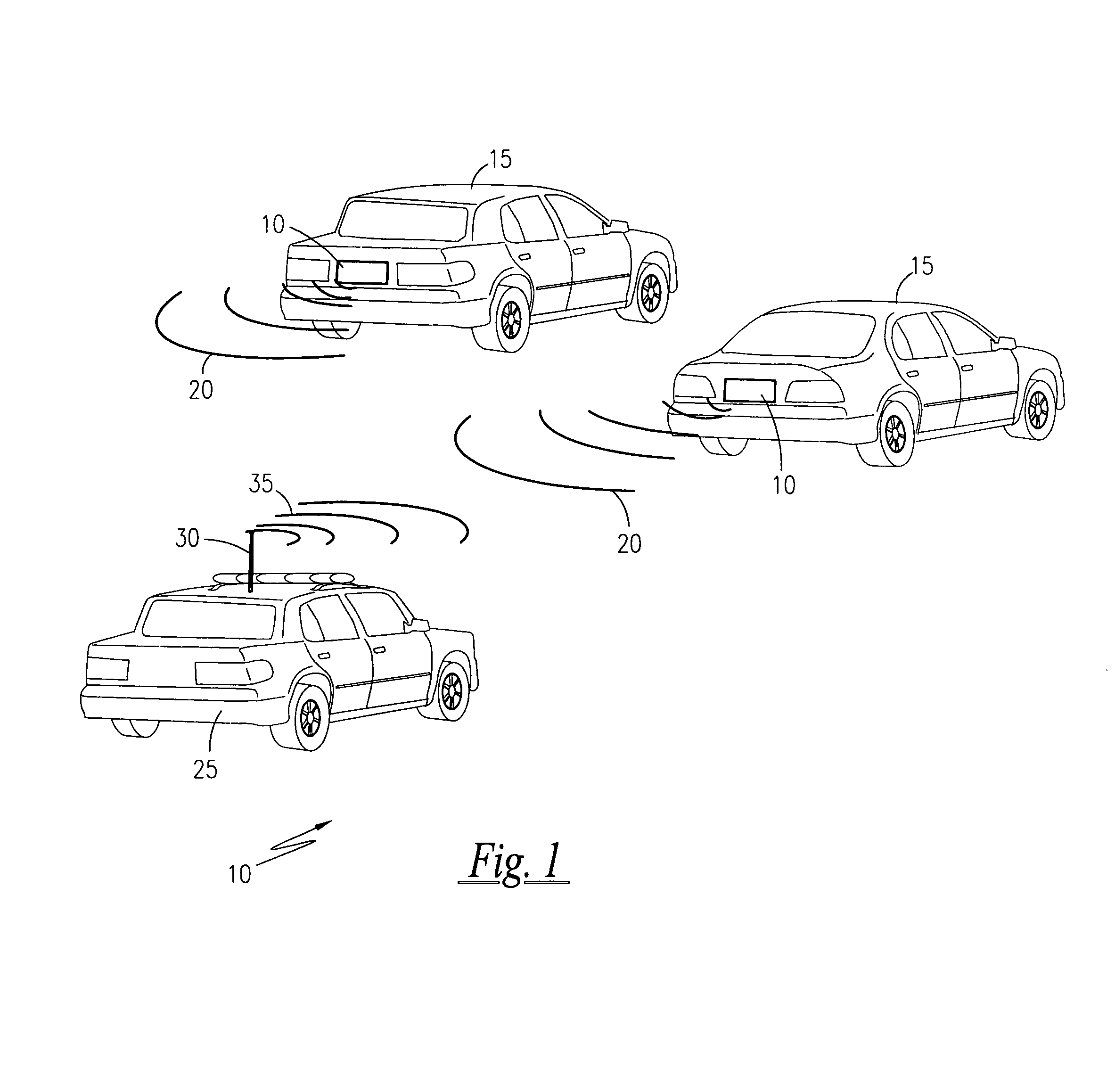

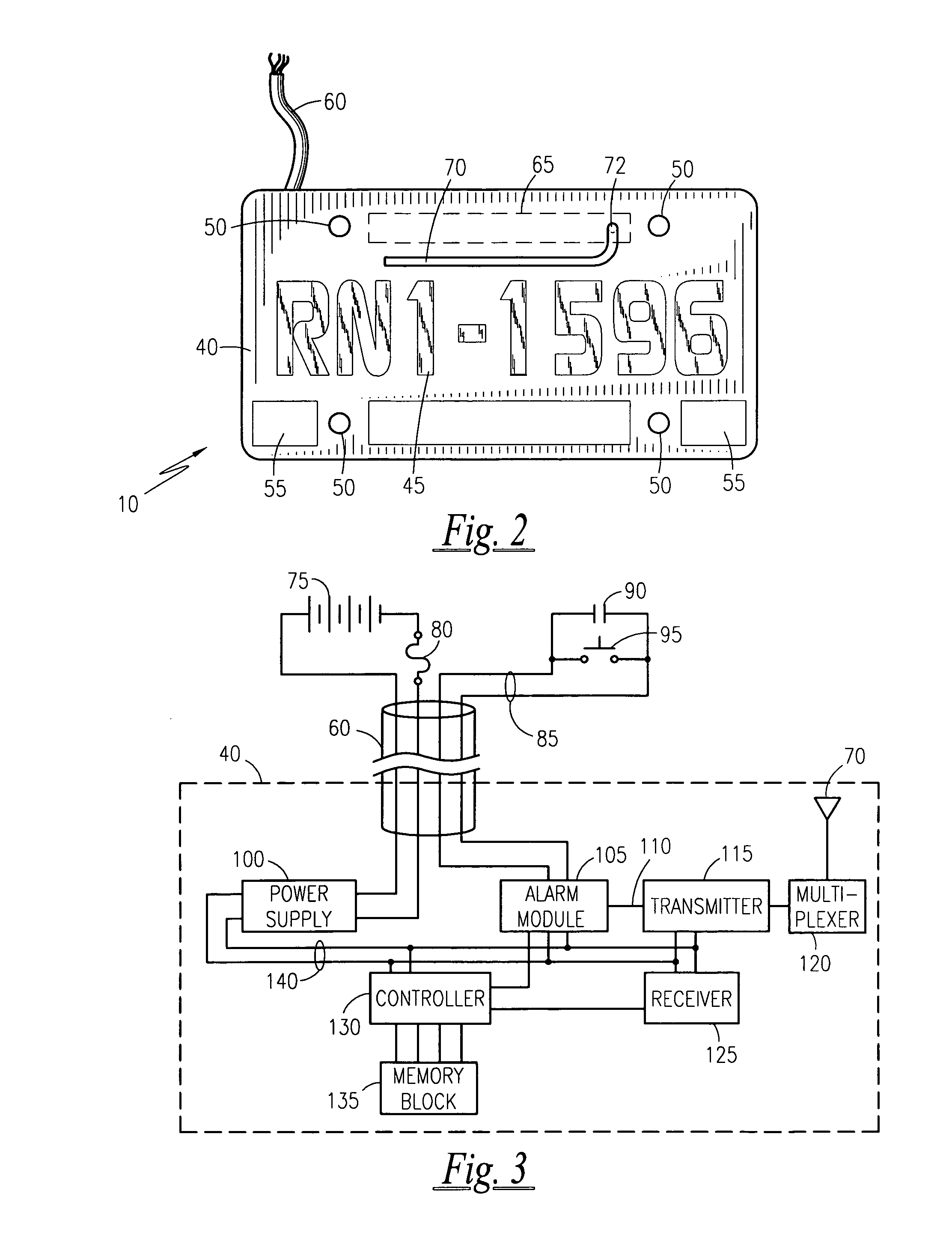

Motor vehicle license plate with integral wireless tracking and data dissemination device

ActiveUS7096102B1Reduce data entryEliminate errorDigital data processing detailsAnti-theft devicesReceiptData entry

An apparatus that provides for the wireless receiving, storing and dissemination of digital data as part of a motor vehicle license plate is disclosed. The apparatus allows for the querying of data typically associated with driving privileges, such as social security numbers, insurance policy information, addresses, registration information, driving records, driving restrictions and the like. Data would be passed wirelessly upon receipt of a valid request signal from a law enforcement vehicle. Such reporting is viewed as a means to reduce data entry and eliminate errors thus freeing the law enforcement officer to perform other duties, or perform multiple queries in the same time as it takes to perform one in a conventional manner. Remote inputs from alarm systems and panic buttons allow for activation of the transmitter portion to alert law enforcement authorities of a possible crime. Such emergency reporting can only be acknowledged and deactivated by authorized authorities.

Owner:PARKER SR HAROLD C

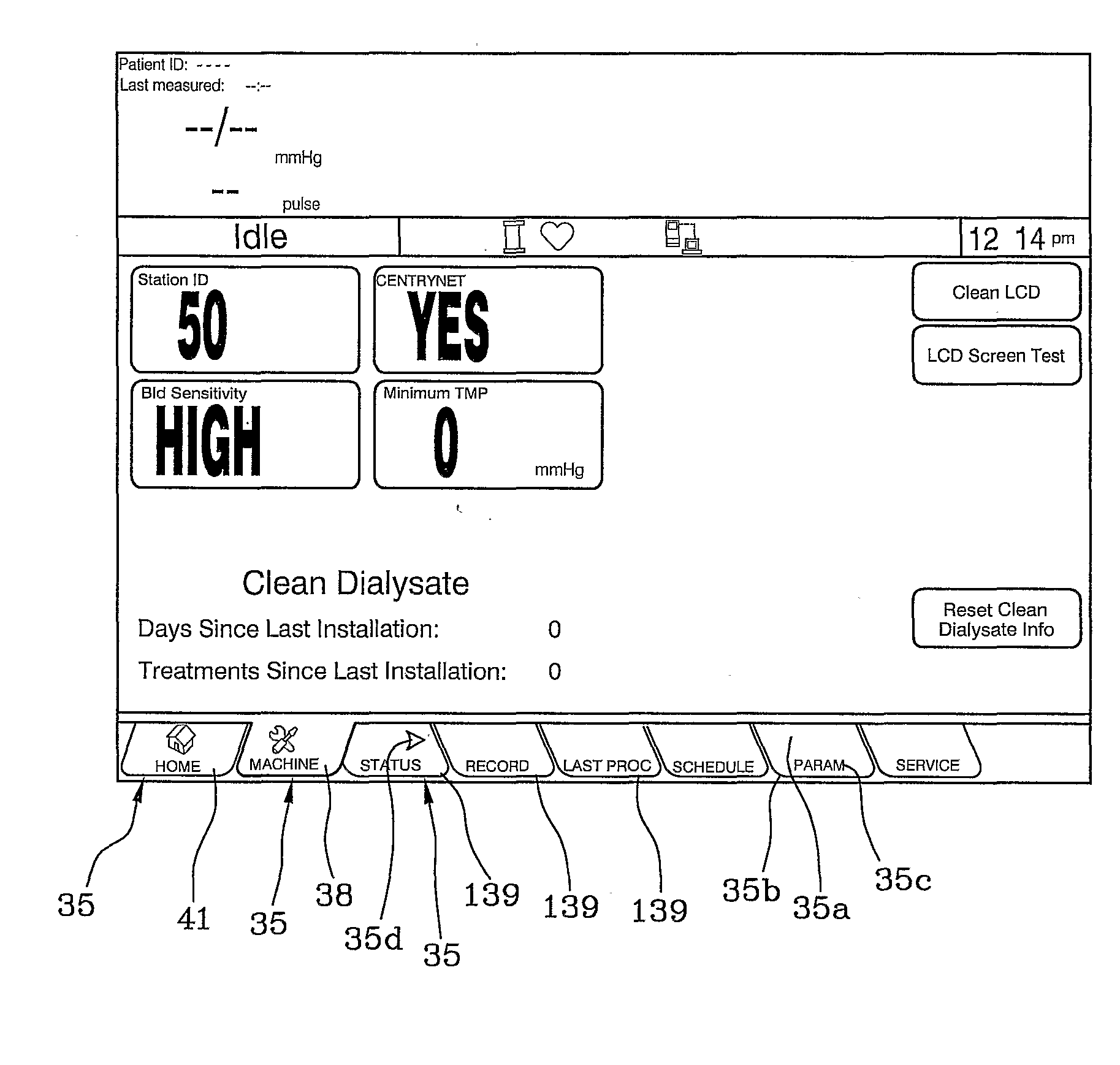

Medical Apparatus and User Interface for a Medical Apparatus

InactiveUS20080307353A1Improve ease and reliabilityReduce data entryLocal control/monitoringDialysis systemsControl systemMedical device

A medical apparatus comprises a user interface (30) enabling setting of parameters and a control system (18) for defining on the user interface screen (31) an operating region (32), where working displays are displayed, and a navigation region (33), where navigation keys (35) are displayed; the navigation keys are organized in a multi-level hierarchical structure where each navigation key has a corresponding working display; the control system verifies selection of a key, displays the corresponding working display in the operating region and displays the following keys in the navigation region: the selected key (38), one or more son-keys (139) of the selected key, and one or more ancestor-keys (41). A method for setting the medical apparatus and a software program is also disclosed.

Owner:GAMBRO LUNDIA AB

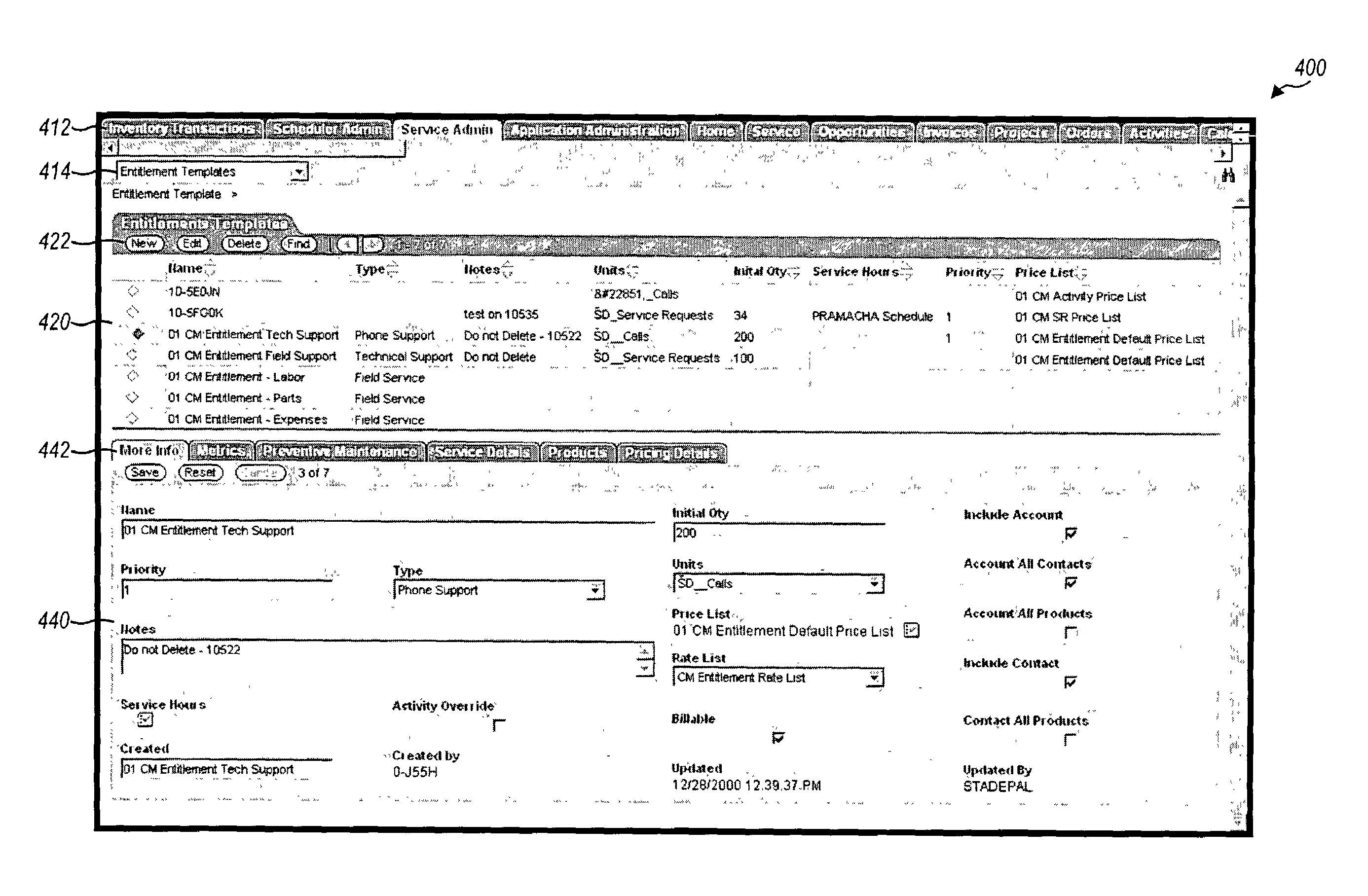

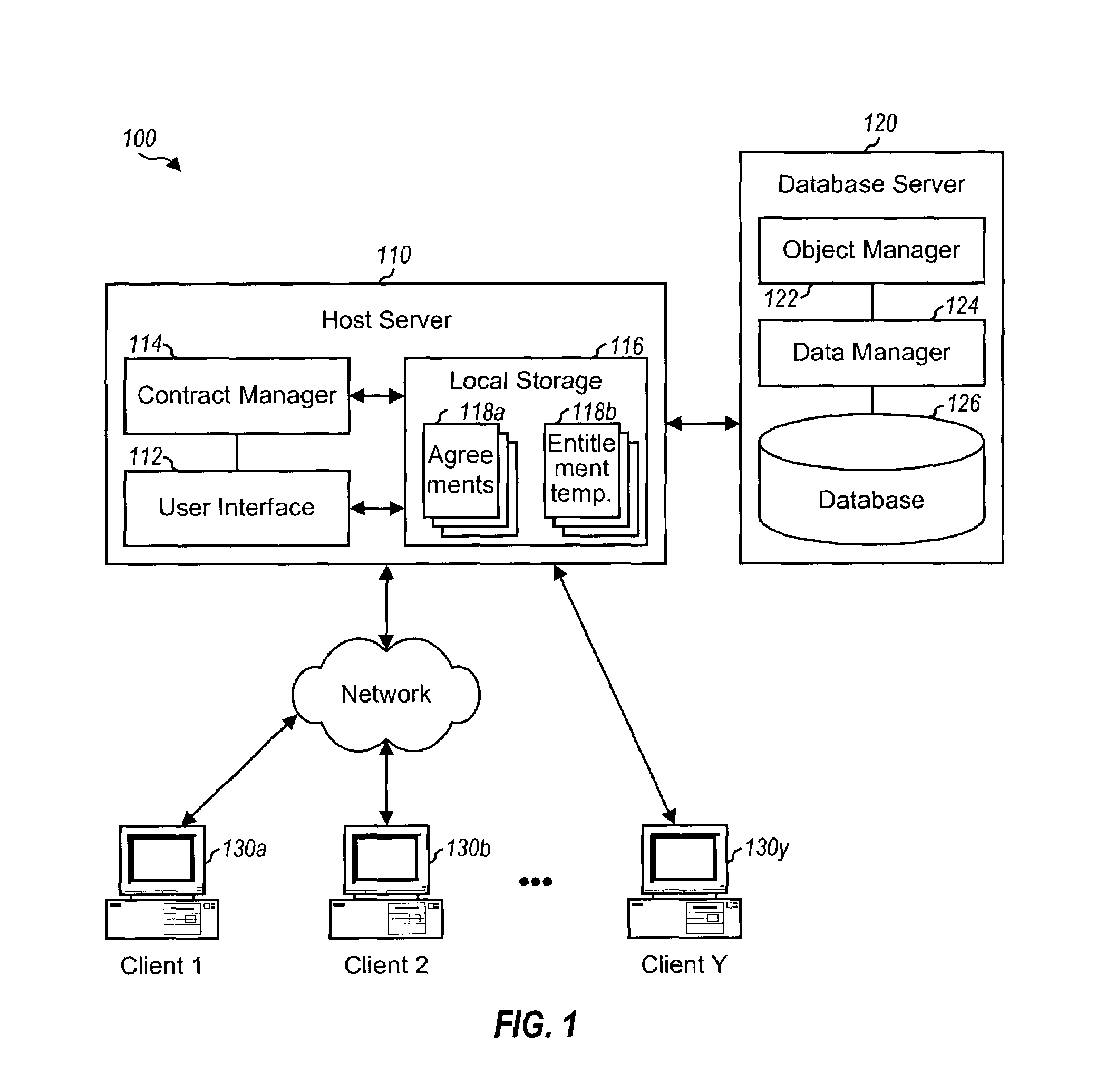

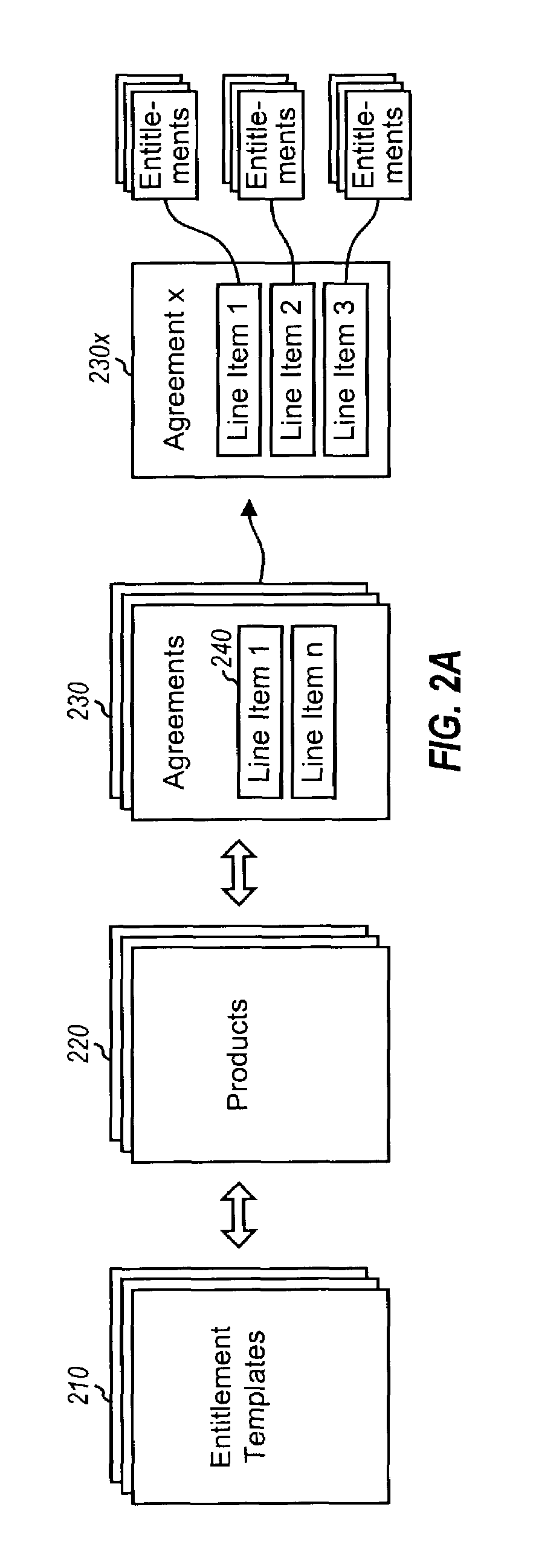

Method and system for instantiating entitlements into contracts

InactiveUS7308410B2Reduce creationSimple processDigital computer detailsMultiprogramming arrangementsProgramming languageLine item

Owner:ORACLE INT CORP

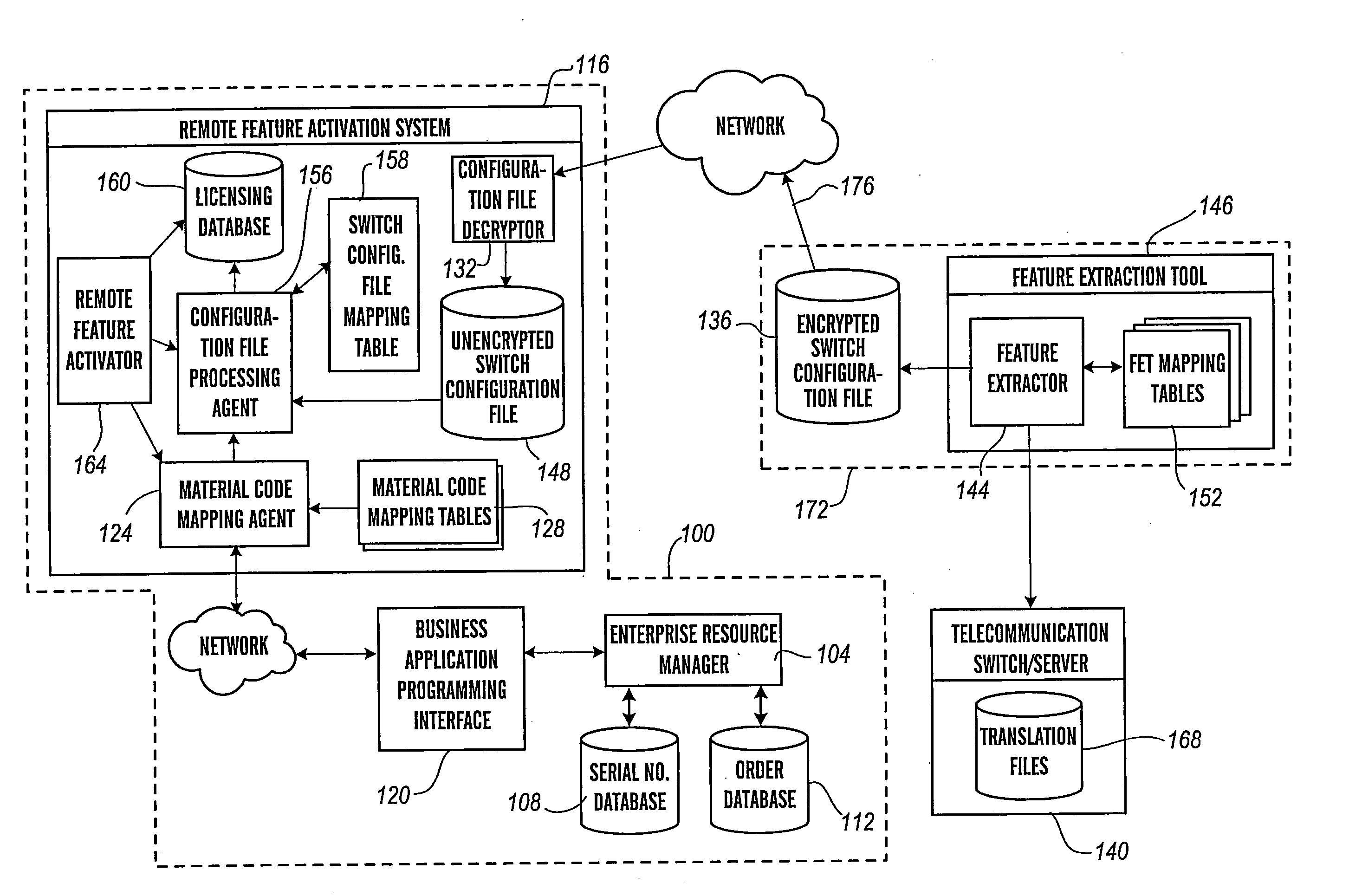

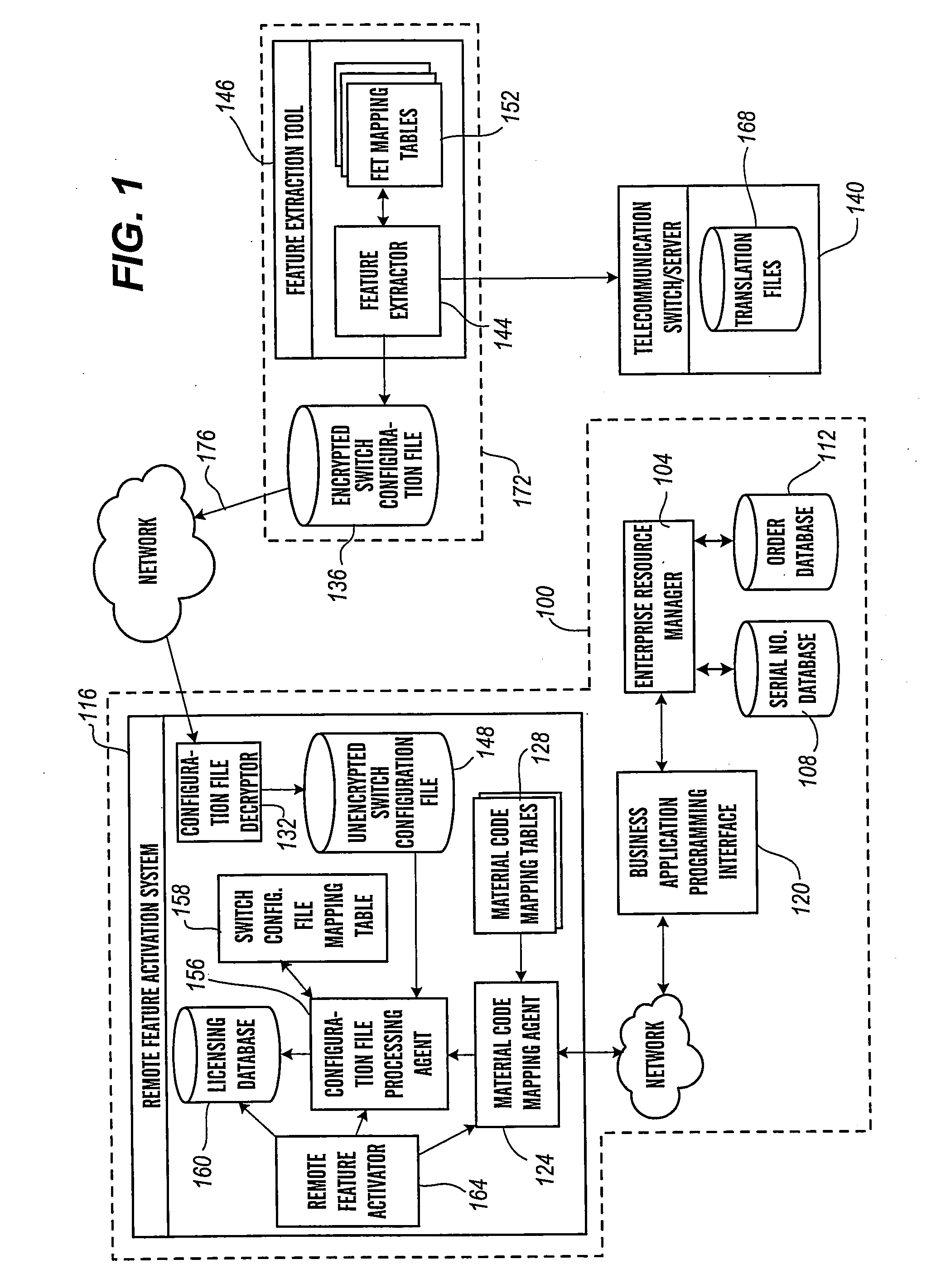

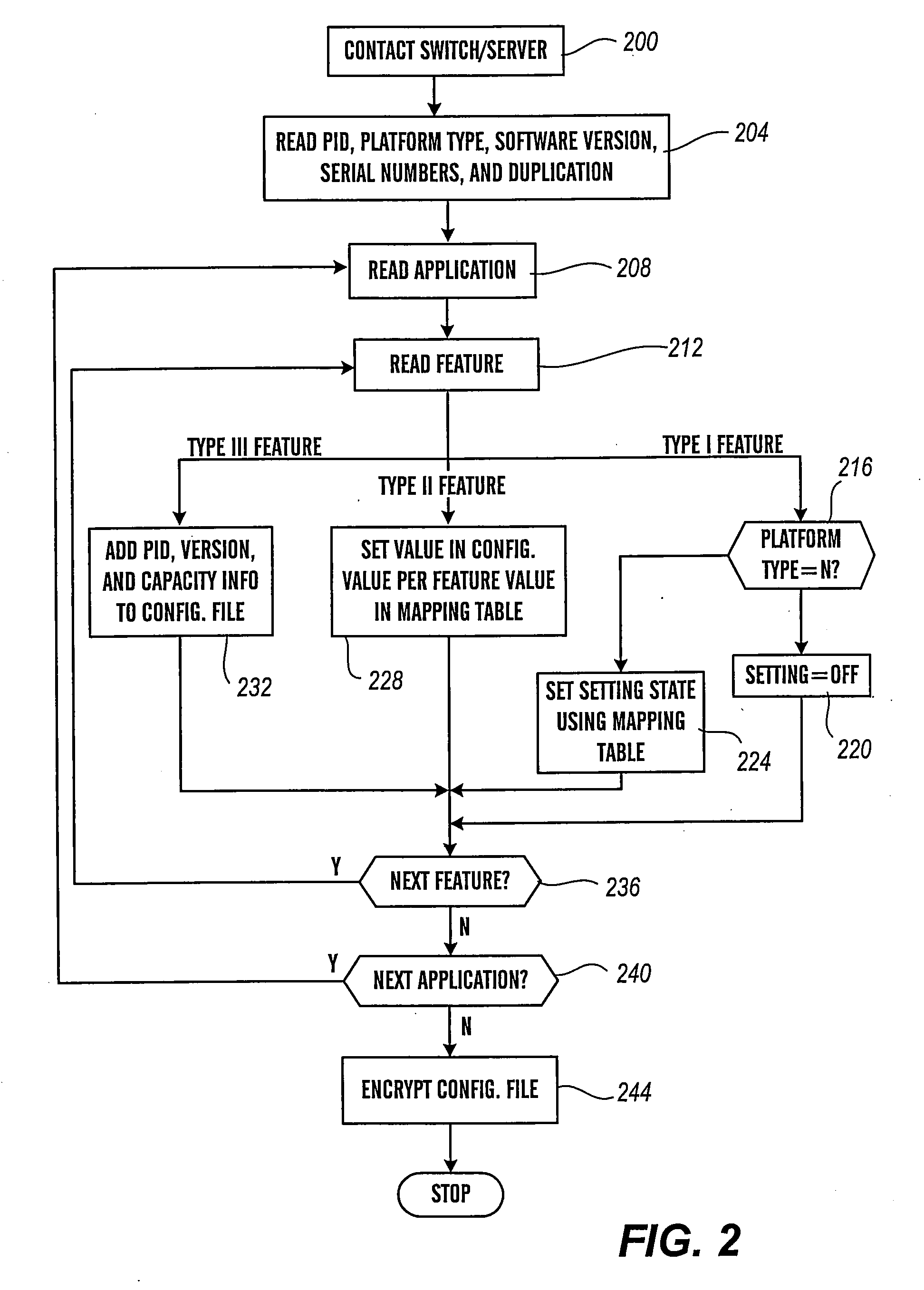

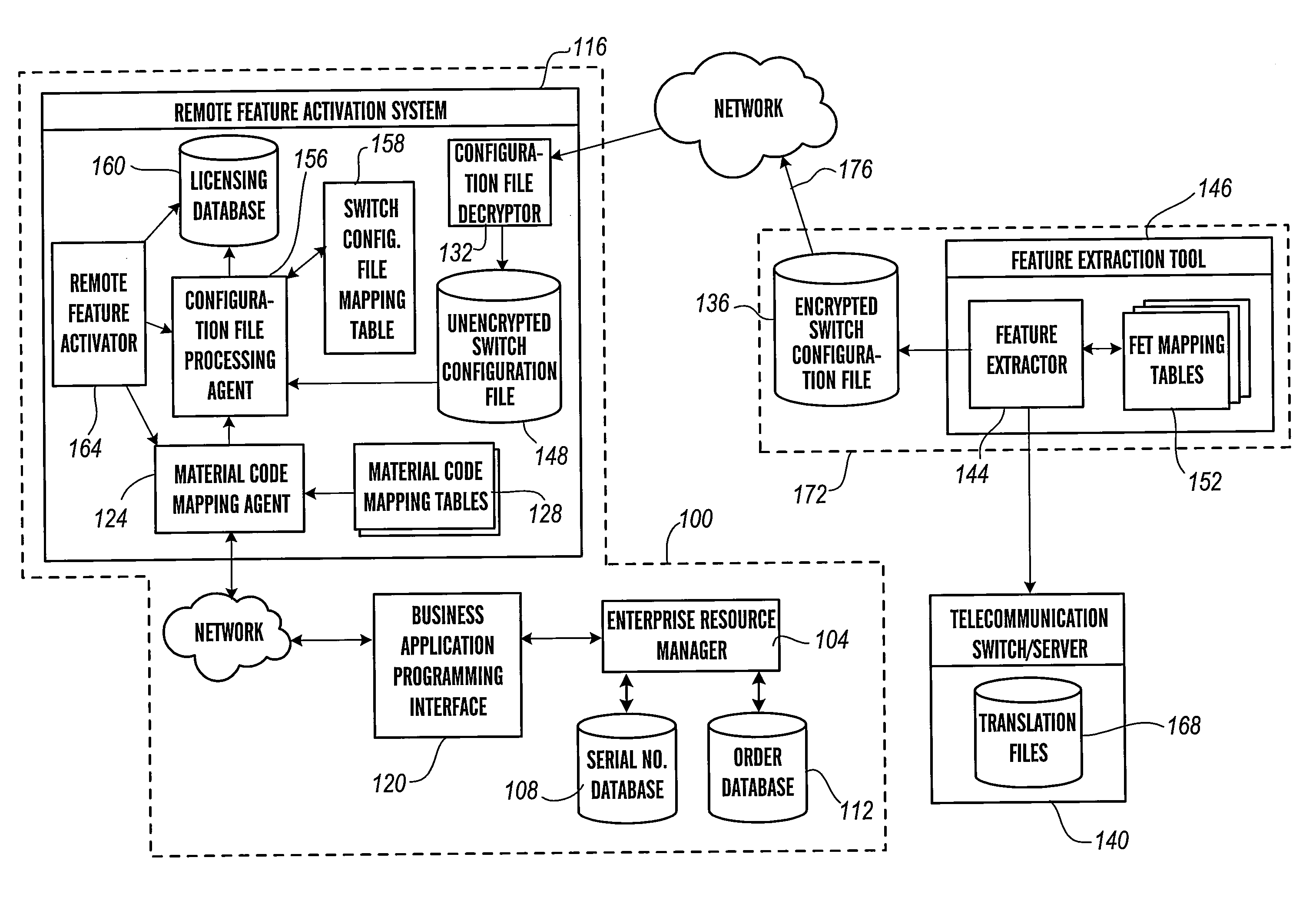

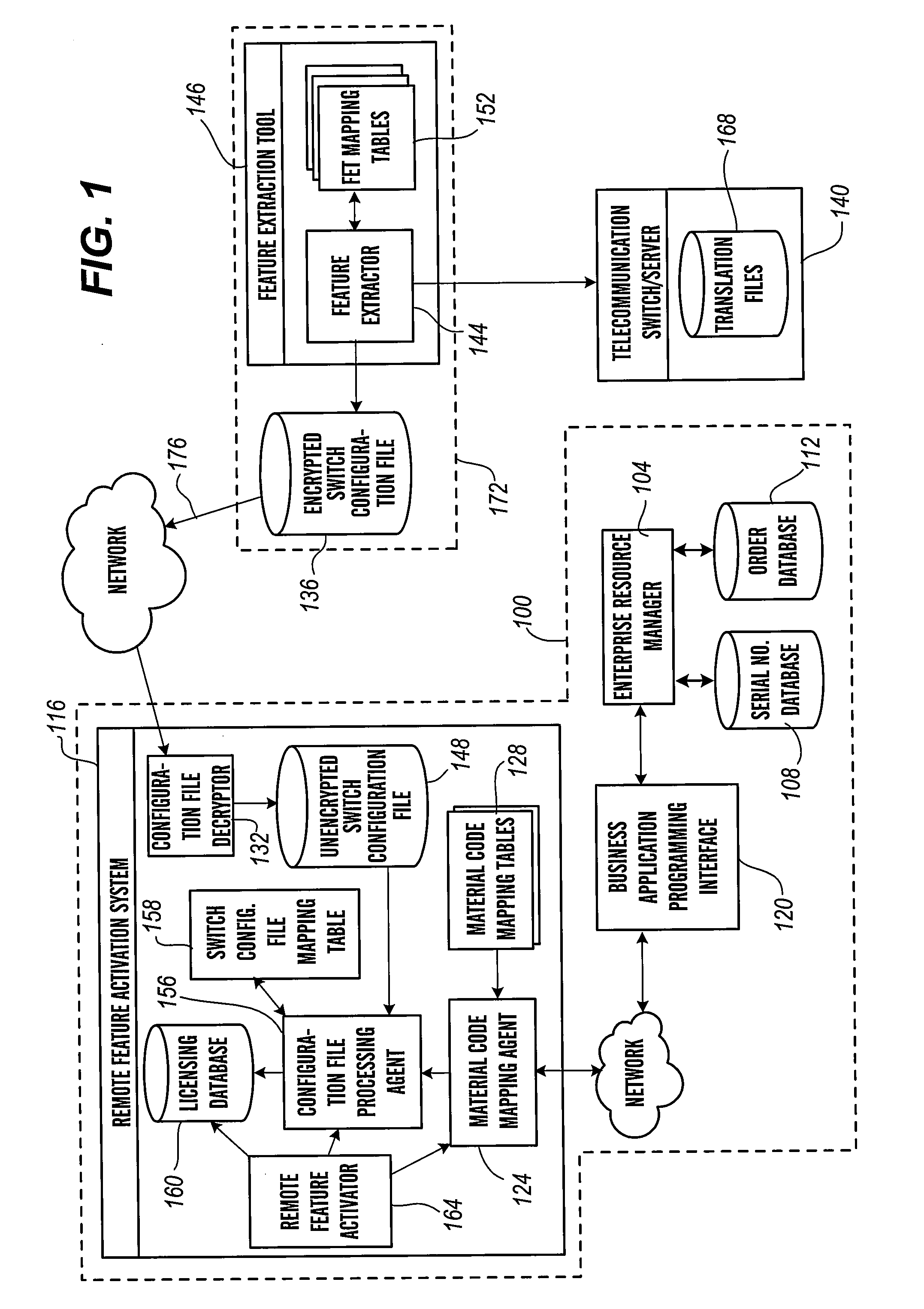

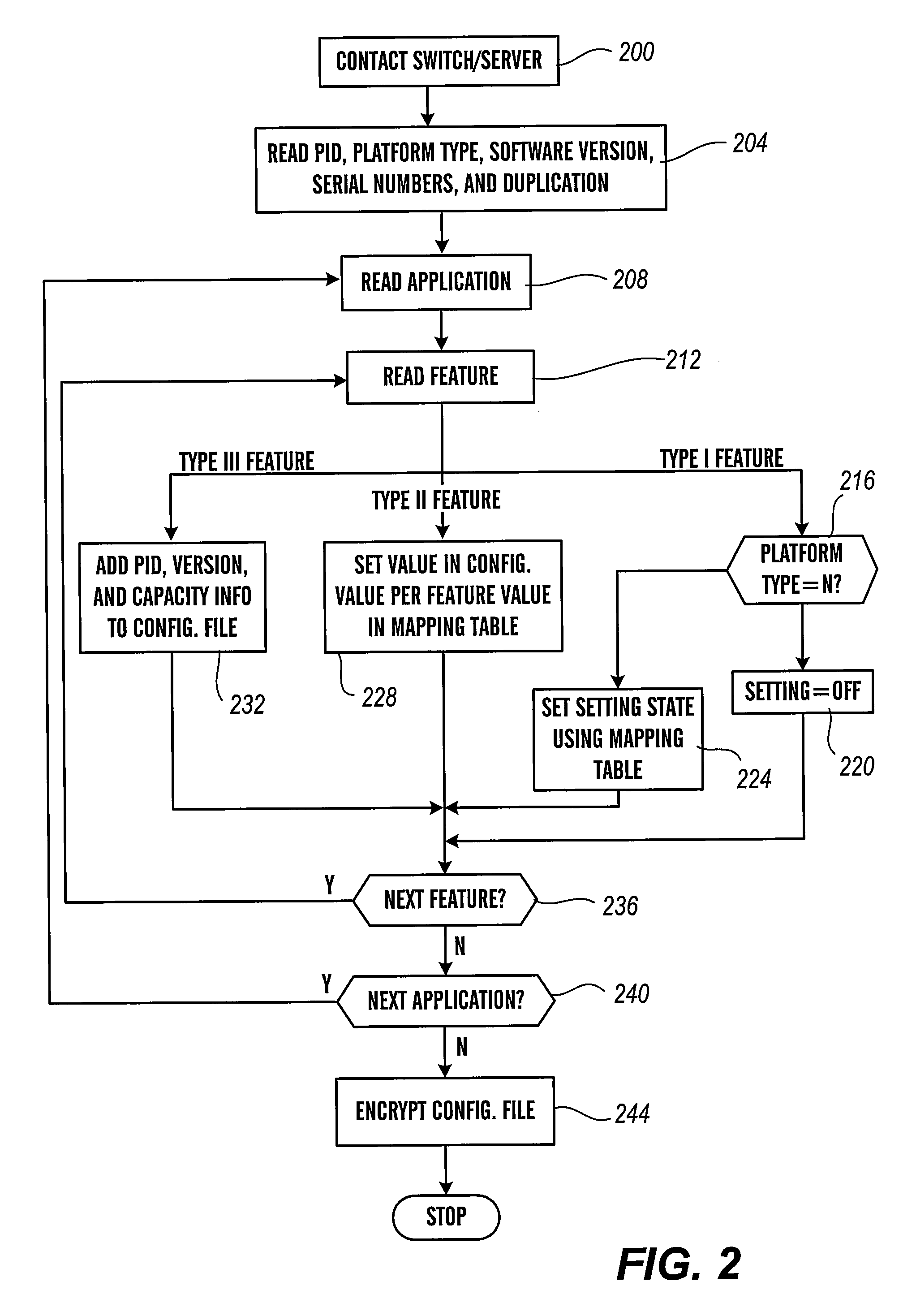

Remote feature activator feature extraction

InactiveUS20080052295A1Shorten the timeReduce errorsDigital data processing detailsAnalogue secracy/subscription systemsFeature extractionComputer science

A database record controls a license to use a computational component. An input receives an order identifier associated with an order related to a computational component and an interface retrieves order information associated with the identifier. The order information comprises at least one material code. A material code mapping agent compares the material code with at least one material code mapping table to identify corresponding computational component information associated with the material code. In another configuration, a transaction record includes first information associated with the order, the order relates to at least a first computational component and / or feature thereof, a configuration file includes second information different from the first information, the configuration file relates to at least one telecommunication switch / server, and a configuration file processing agent compares some of the first information with some of the second information to form a system record having both first and second information.

Owner:AVAYA TECH LLC

Medical Apparatus and Method for Setting Up a Medical Apparatus

ActiveUS20080209357A1Improve ease and reliabilityReduce data entryLocal control/monitoringDialysis systemsData validationVideo memory

A medical apparatus comprises a user interface for setting parameters and includes: a screen for visualizing values of said parameters, a main control unit connected to the interface, a first memory and a video memory both connected to the main control unit for storing data corresponding to images on screen; the main control unit allows setting of a new value for a parameter, displays the new value on a screen region, stores the new value in the first memory, captures from the video memory data representative of said screen region, verifies from said representative data if the displayed value corresponds to the value in the first memory. A method for setting up a medical apparatus is also disclosed.

Owner:GAMBRO LUNDIA AB

Automated discovery, assignment, and submission of image metadata to a network-based photosharing service

InactiveUS20060020624A1Reduce data entryData processing applicationsDigital data processing detailsMetadata discoveryImage sharing

An automated metadata discovery, assignment, and submission system is disclosed. The system includes a photosharing service coupled to a network through a server, where the server stores metadata fields. The system also includes at least one client computer capable of communicating with the server over the network, where the client computer stores a plurality digital files and an automation application. When executed, the automation application establishes communication with the photosharing service and downloads the metadata fields. The content of a first file is then automatically analyzed and one or metadata values are assigned to the downloaded metadata fields based on the analysis. In addition, the automation application automatically discovers any pre-existing metadata values associated with the file and uses the metadata values to populate corresponding downloaded metadata fields. Both the pre-existing and automatically assigned metadata values are then displayed to the user for viewing and editing. The metadata values assigned to the file are recoded for use with a next image, and the file and the metadata values are uploaded to the photosharing service for storage.

Owner:CHEMTRON RES

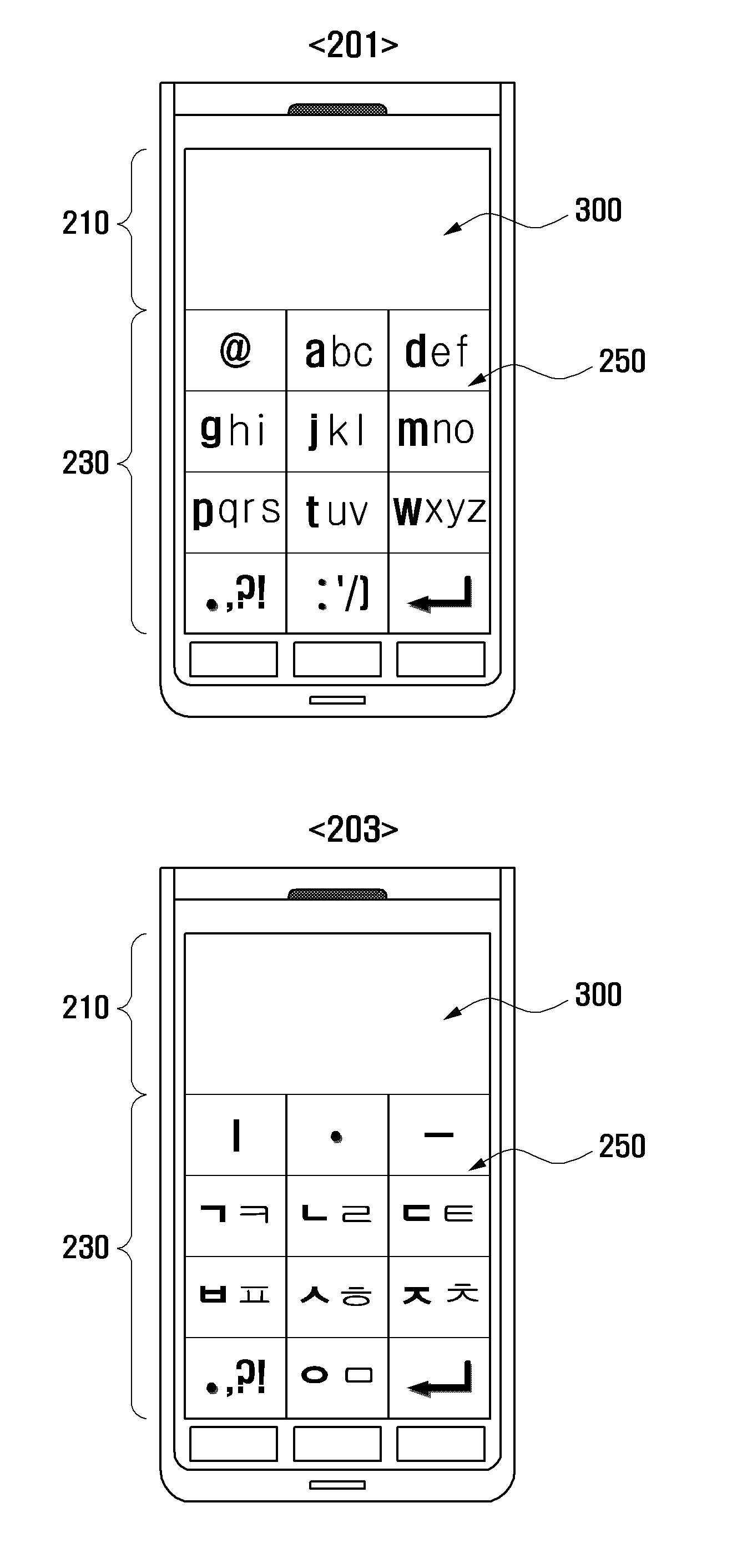

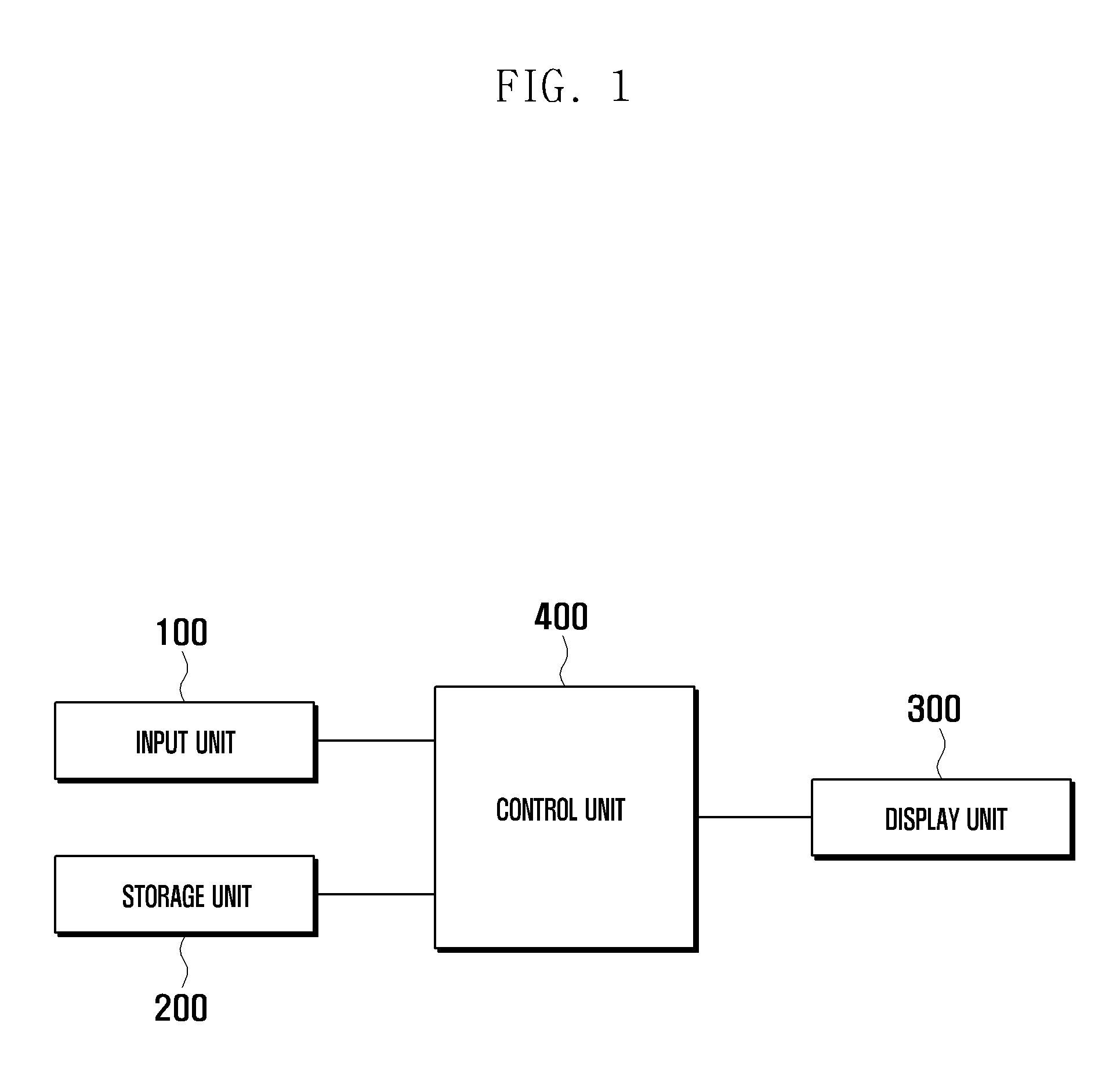

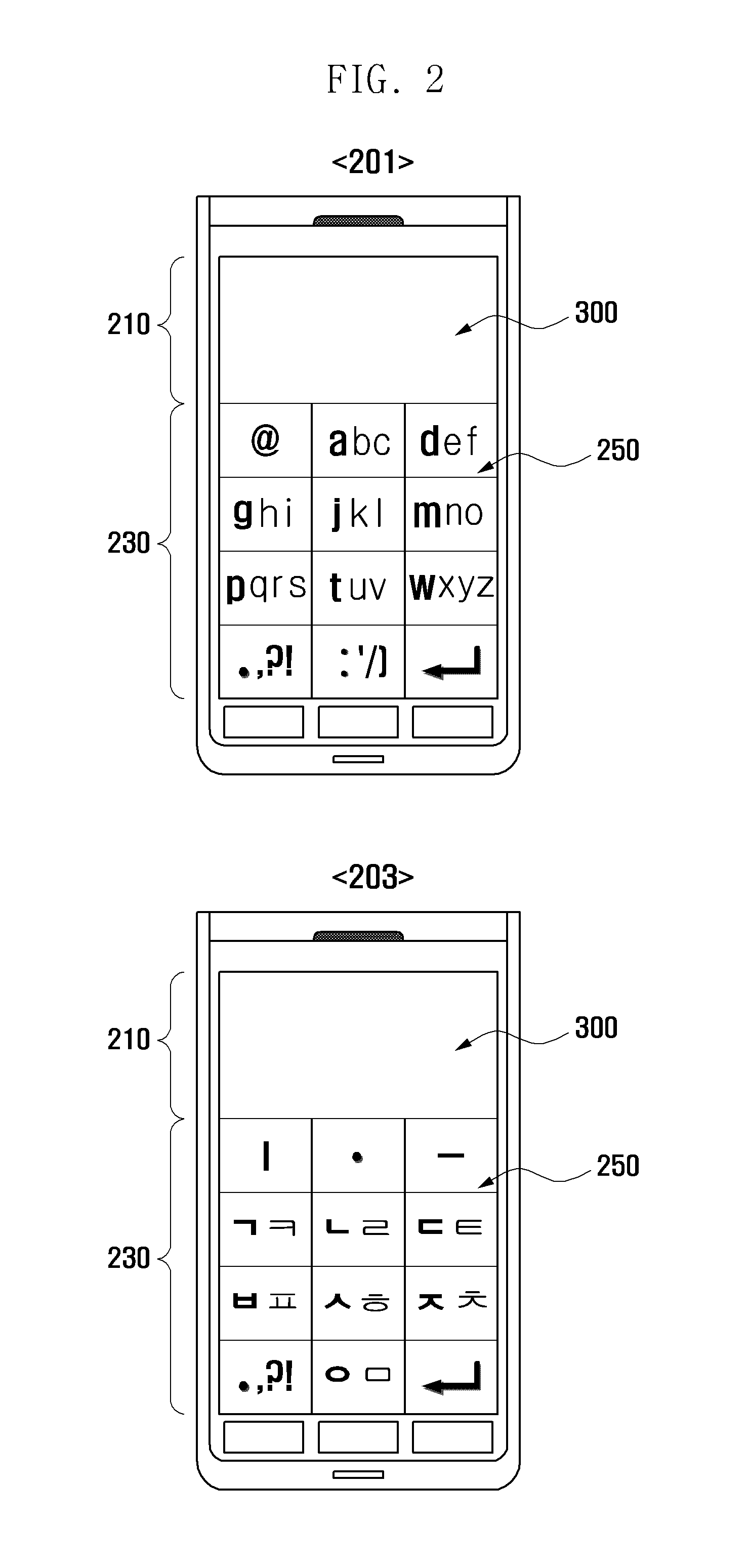

Touch-enabled terminal and method of providing virtual keypad for the same

ActiveUS20110246927A1Simple methodReduce data entryDigital data processing detailsSubstation equipmentComputer scienceVirtual keyboard

Owner:SAMSUNG ELECTRONICS CO LTD

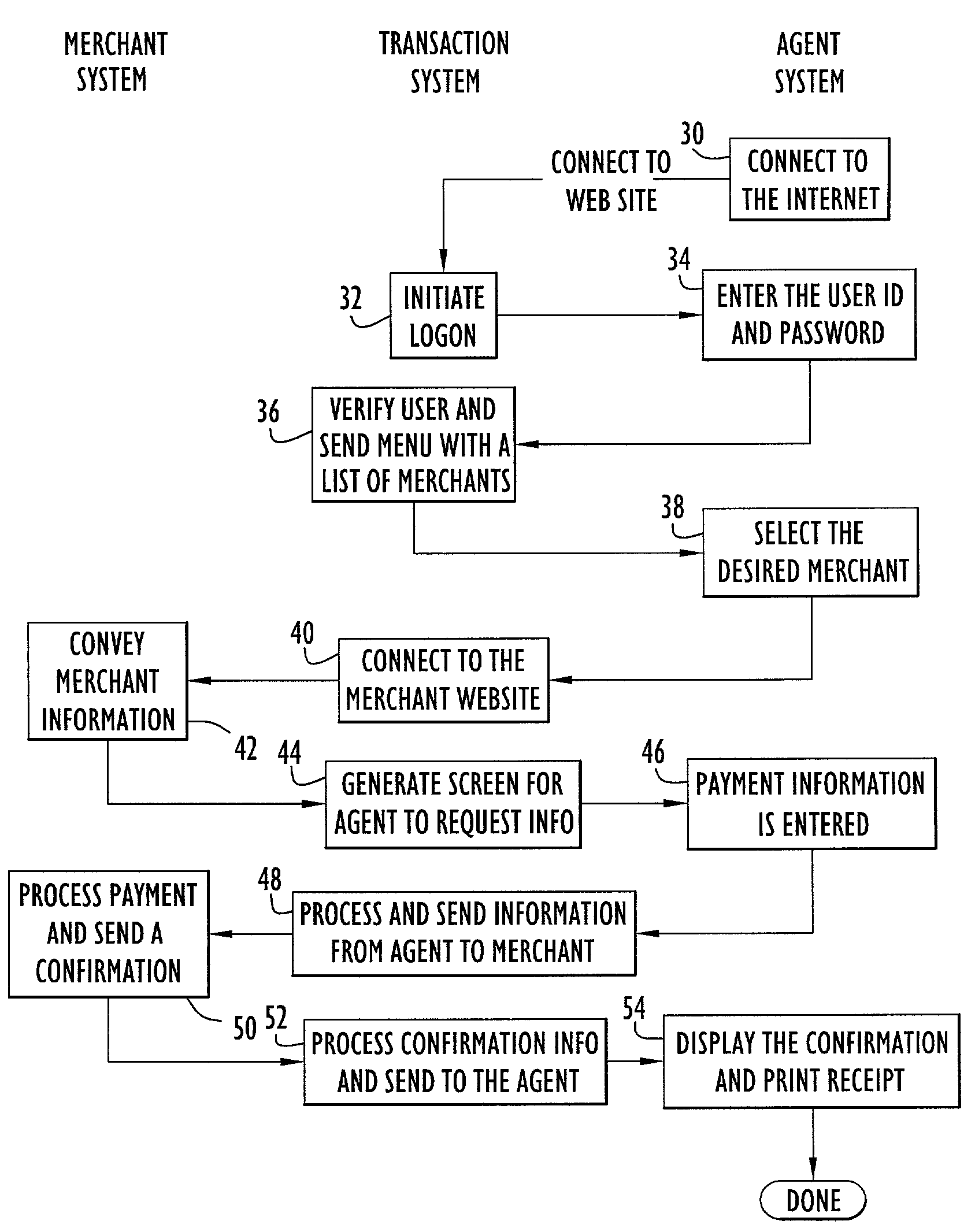

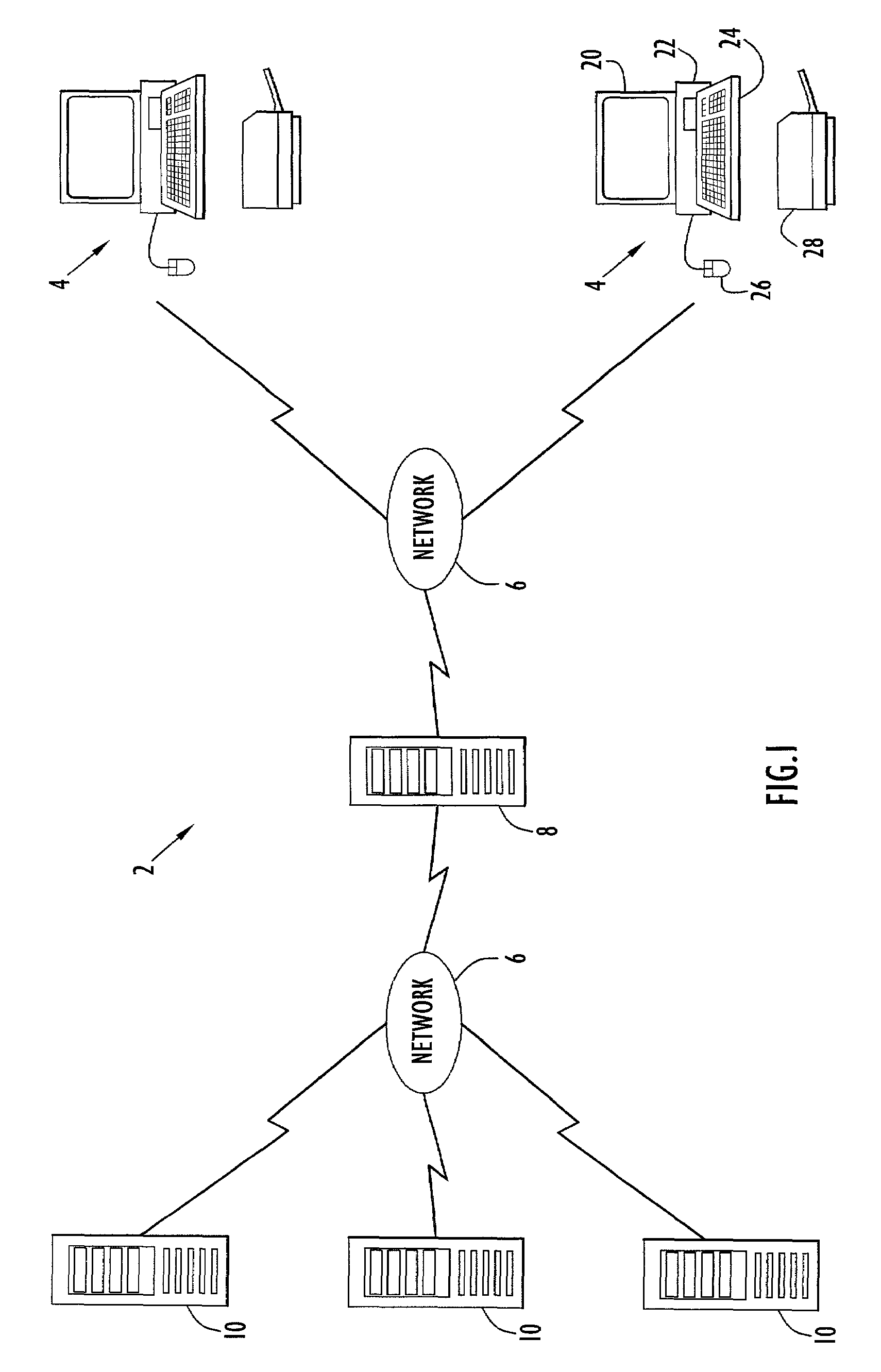

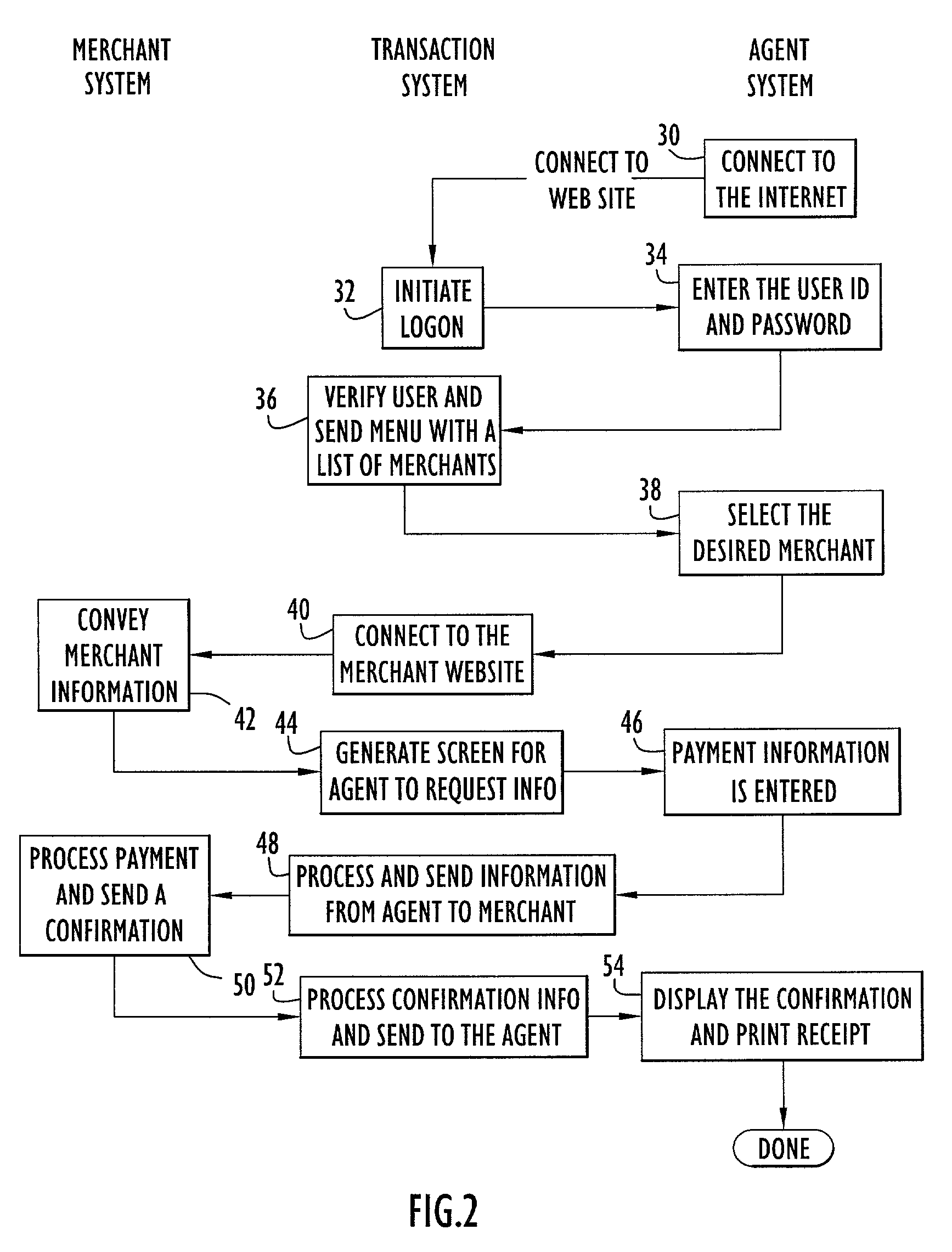

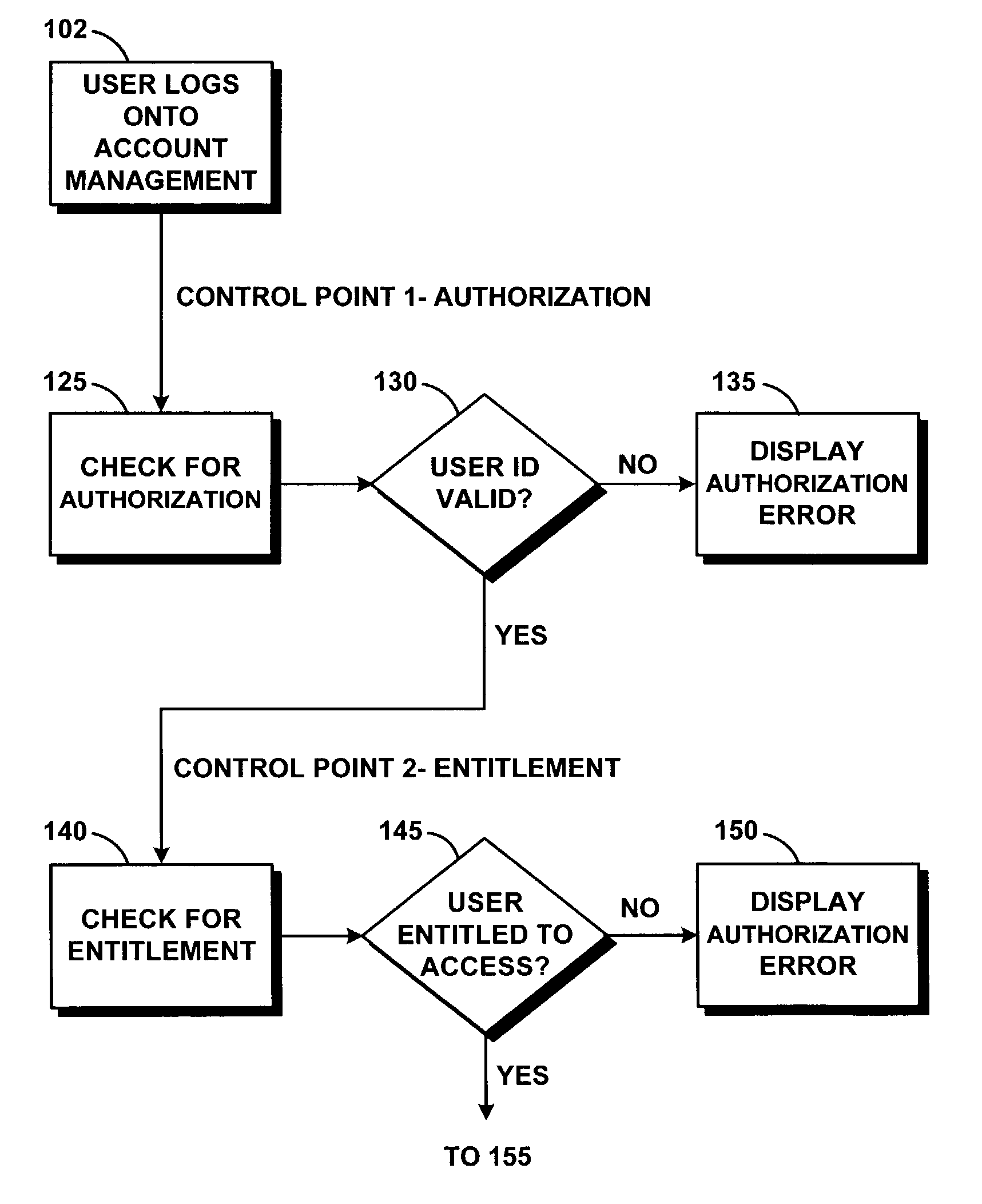

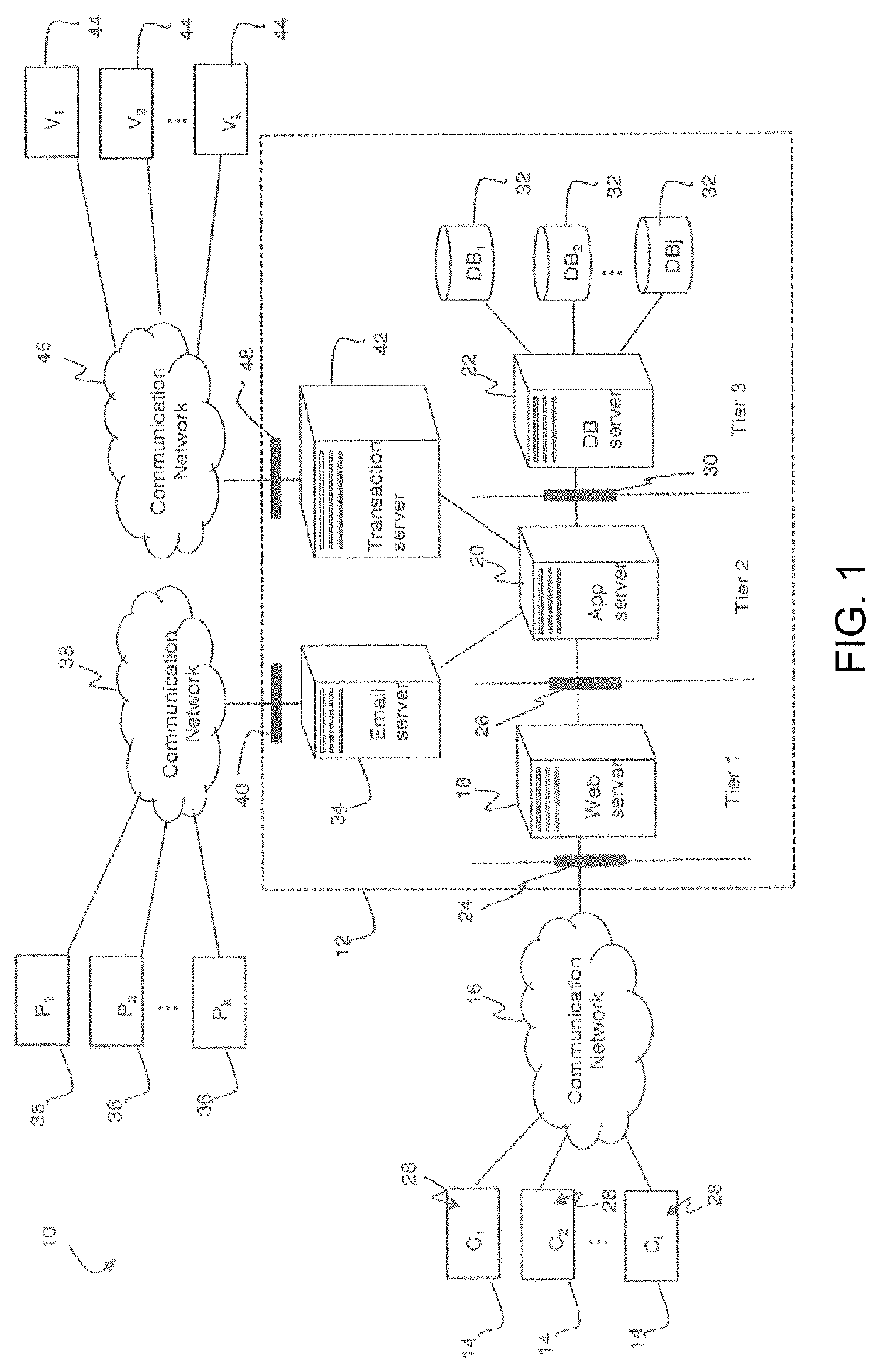

Method and apparatus for facilitating manual payments for transactions conducted over a network

ActiveUS7296003B2Good serviceExpanding good provider accessibilityComplete banking machinesFinanceCredit cardWeb site

A system enables tender of payment manually (e.g., cash, check, etc.) for transactions conducted over a network (e.g., the Internet). The system includes one or more computer systems each located at a corresponding agent site, one or more merchant systems and a server computer system in communication with the agent and merchant systems. The server system accesses the appropriate merchant network or web site in response to transaction selection information received from the agent system, and translates those web pages for transmission to the agent system. The server computer system further receives the required transaction information from the agent system and processes the transaction information for transference to the particular merchant web site. In addition, the server system enters credit card information of a provider of the transaction service within the transaction payment information for transference to the merchant system in order to tender payment for the network transaction.

Owner:PAYPAL INC

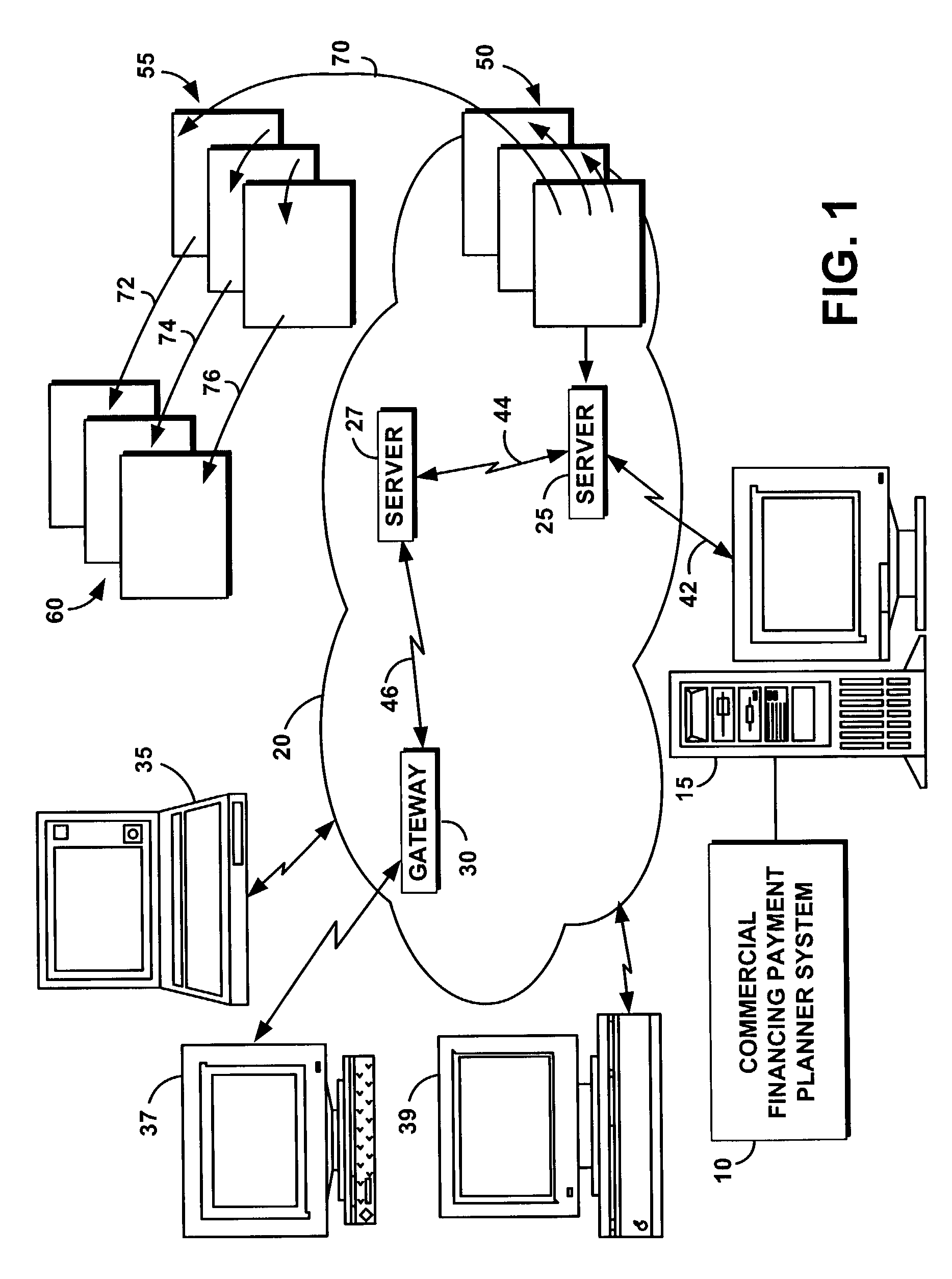

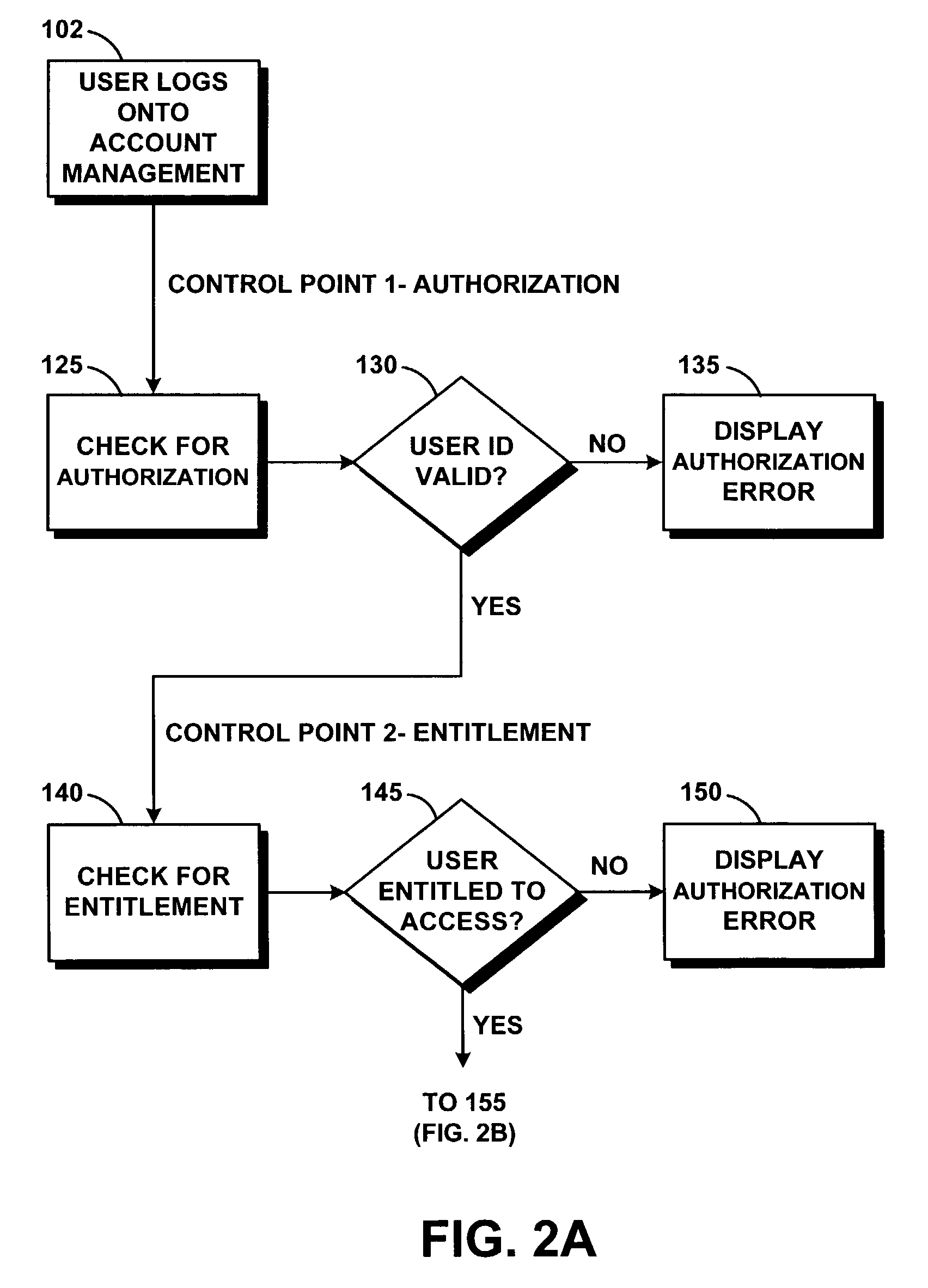

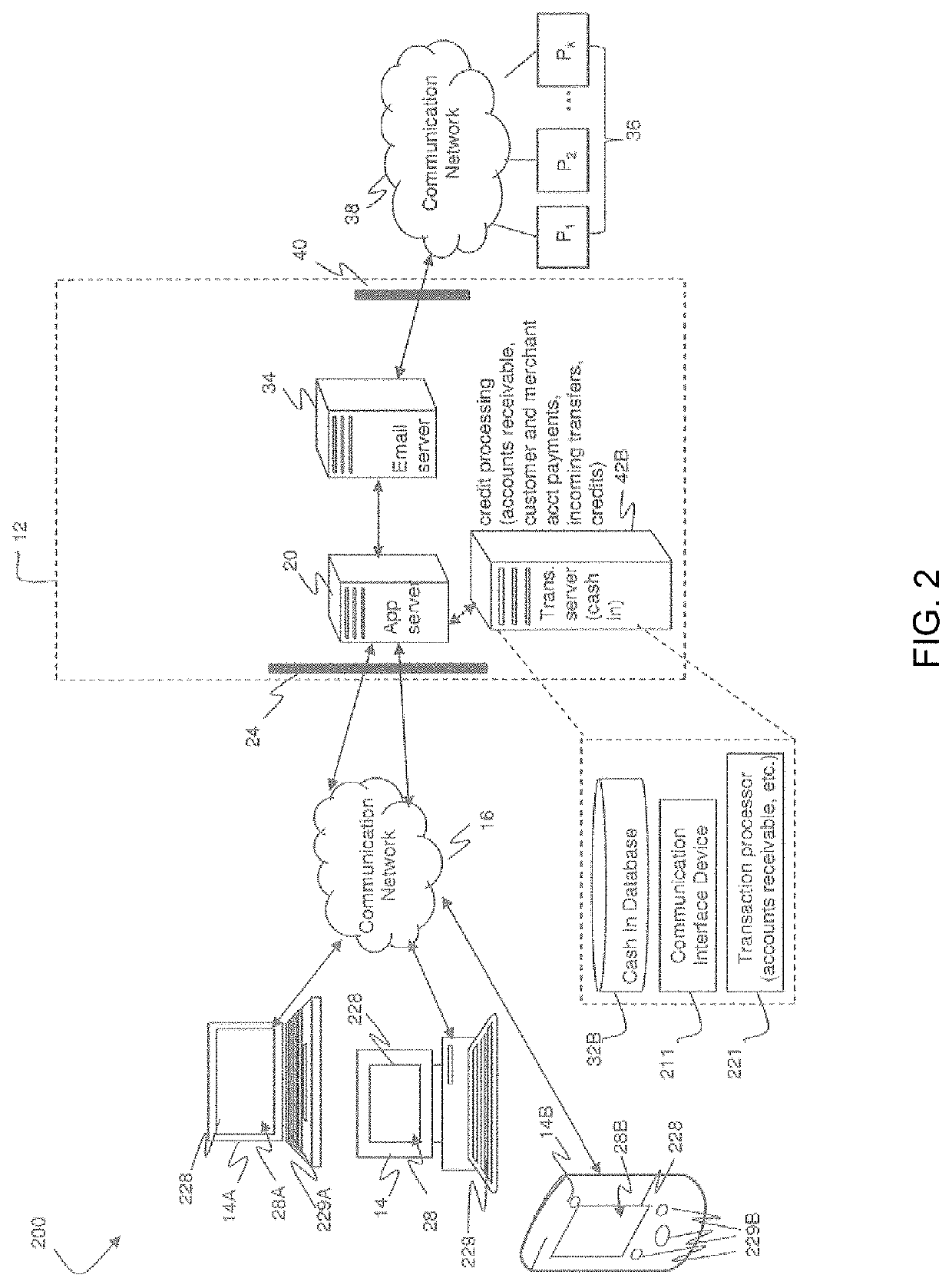

Method for planning commercial financing payment

A commercial financing payment planning system and associated method provide commercial financing customers the ability to retrieve and monitor account activity, track scheduled payment dates, and create / submit remittance instructions online. The system provides numerous functions to a customer, such as customer payment control, access to multiple payment sources by the customer, automatic funds transfer, customized user access, a customer dispute process for disputing supplier invoices, automatic dispute response, and credit tracking. With payment control, the customer specifies which and on what date the invoices will be paid, and the source of funds for the payments. The customer can make these payments from one or a combination of sources. By creating a remittance advice document, the customer can specify in advance payment details and give authorization for automatic payment by the system. The customer can also customize access to control features of the system of the invention for each of the customer's accounts / receivable employees. In the event that the customer has an issue with a supplier's delivery, product, or pricing, the customer can submit a dispute to a supplier. The customer, supplier, and finance company can view a payment dispute and dispute status through the entire dispute process. The system automatically e-mails the customer a response when the dispute is resolved, informing the customer of the result of the resolution. Both the finance company and the customer can track credits applied to the customer's account through the entire dispute process.

Owner:PAYPAL INC

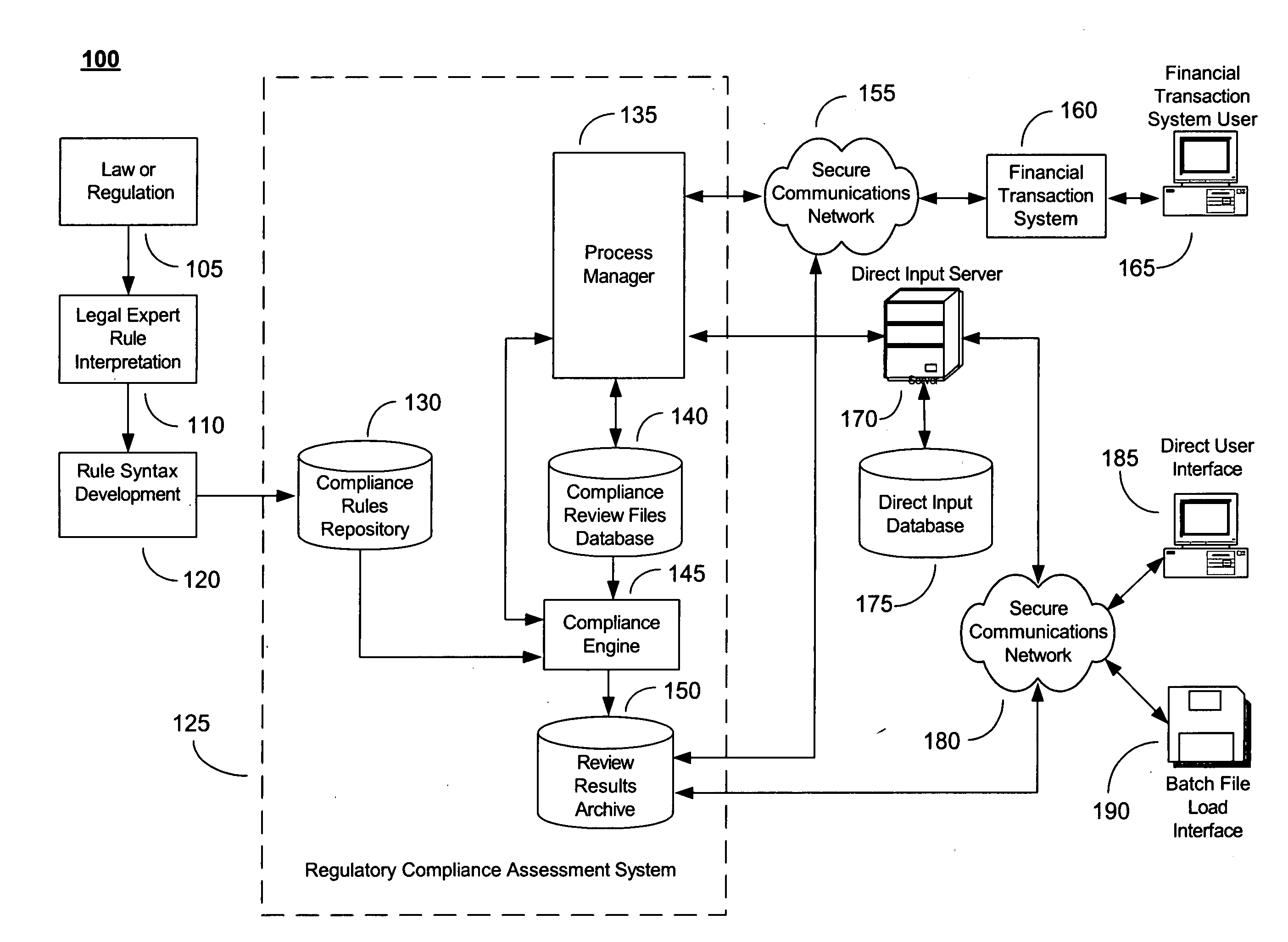

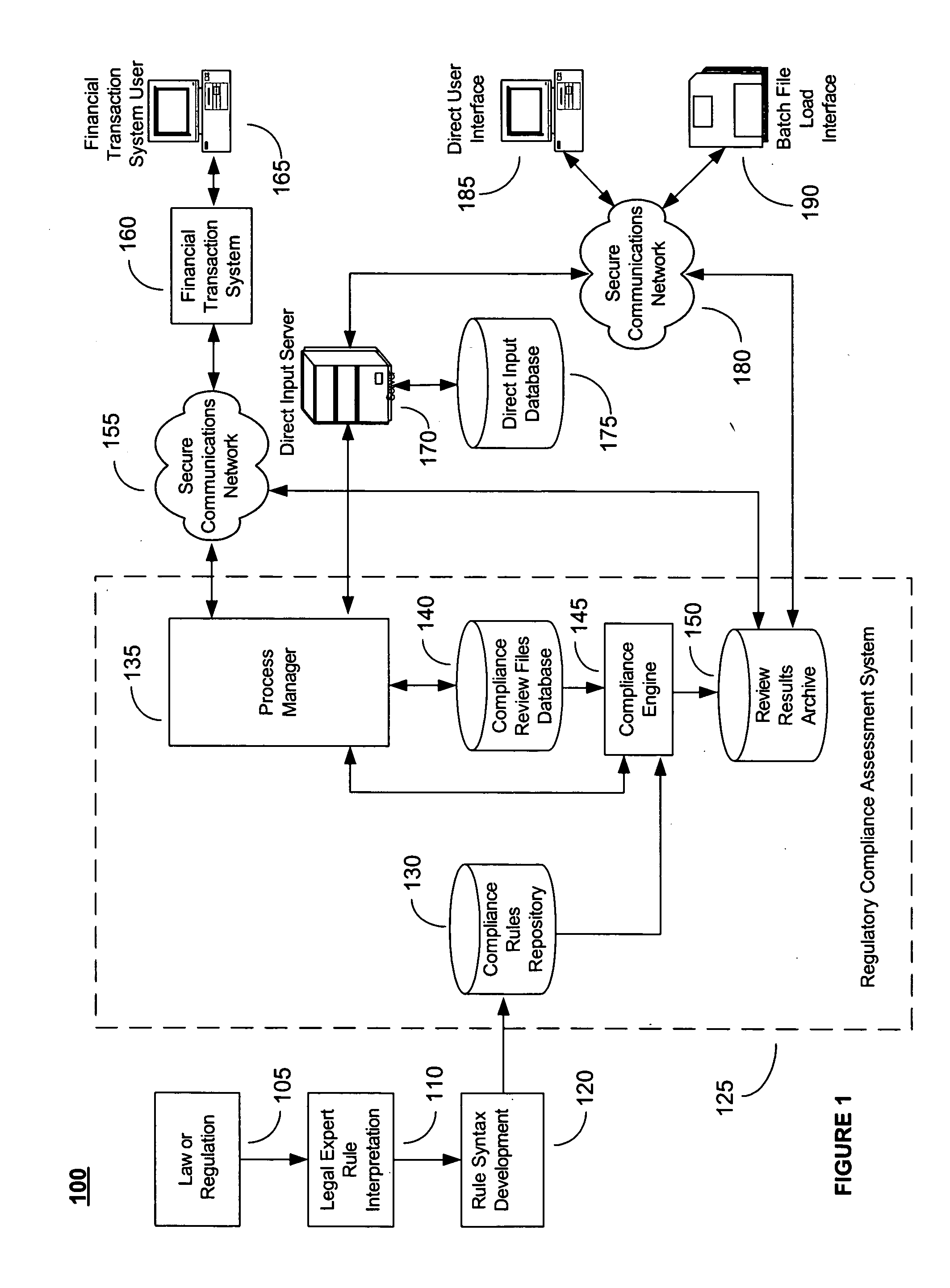

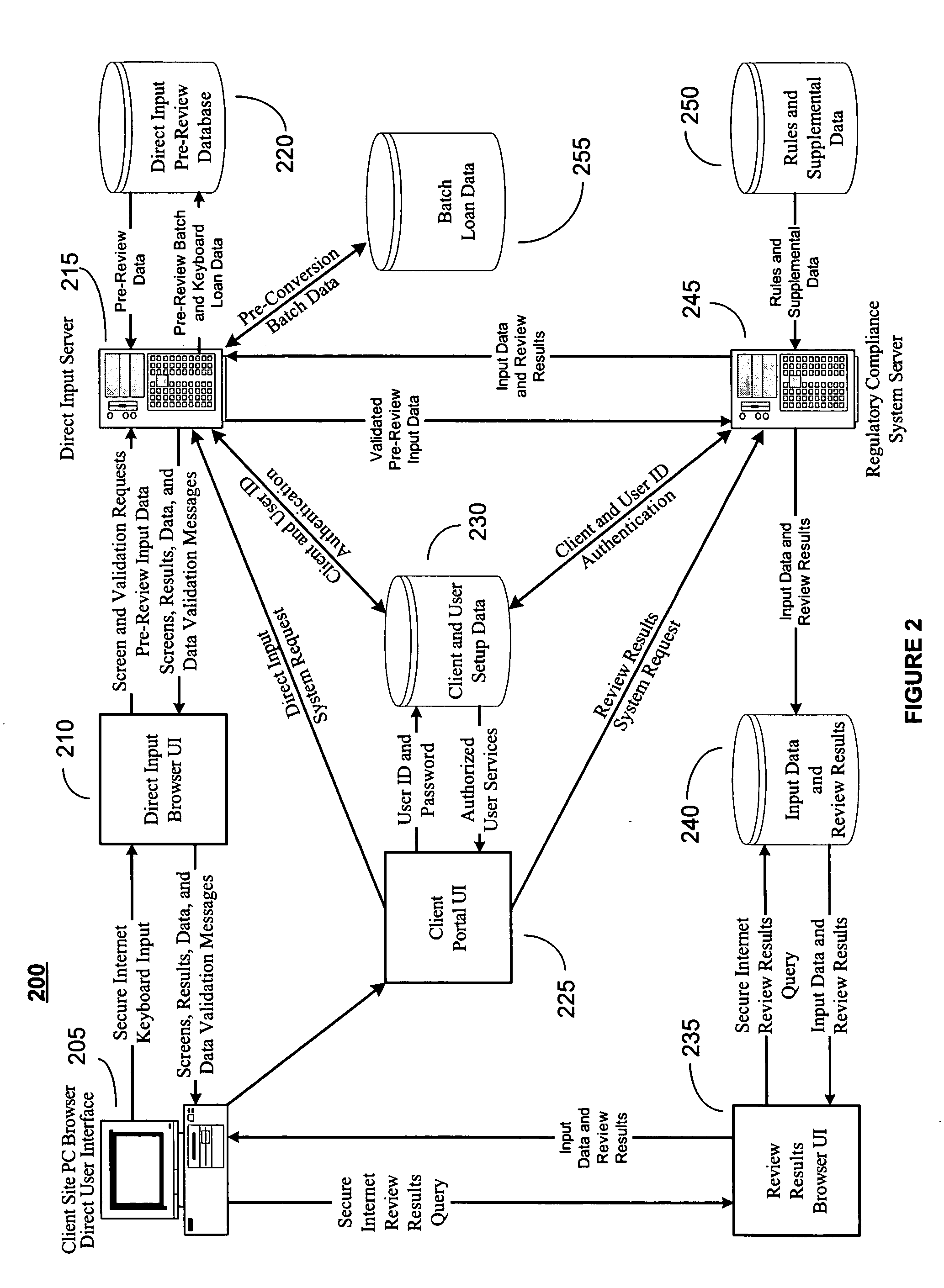

System and method for two-pass regulatory compliance

An automated system and method for ensuring that information in the form of data files provided by highly regulated businesses, such as financial institutions, comply with the most currently applicable Federal, state and local laws and regulations. This may be accomplished by applying a set of computer-encoded compliance rules to the transaction data files from these businesses in a two-pass regulatory compliance review methodology. In a first pass, a limited set of input data elements from one or more input transaction data files is used that results in an extremum or worst-case condition for compliance assessment by using one or more compliance rule sets. The transaction data files that are found to be not in compliance when using this limited set of data elements may or may not be in compliance when using a more complete and detailed set of data elements in a second pass.

Owner:MAVENT HLDG

Deep-linking system, method and computer program product for online advertisement and e-commerce

ActiveUS20170228797A1High return on investmentImprove click-through rateAdvertisementsWeb data indexingMobile appsWeb site

Embodiments disclosed herein can leverage dynamic data, fields and implied information from arbitrary web sites, mobile apps and other forms of online media to create a universal variable map and automatically generate deep-linked ads utilizing the universal variable map, linking any arbitrary web site, mobile app, network, Internet TV channel, and other forms of online media to any other such arbitrary web site, mobile app, network, Internet TV channel, and other forms of online media. The automatically generated deep-linked ads can be inserted into any ad server and served out from there in real-time. A deep-linked ad thus presented to a user can take the user from a starting page on one site or application where the ad is displayed directly to a resulting page such as a checkout page on another site or mobile application, with pertinent information already pre-populated, and action already initiated for the user.

Owner:METARAIL INC

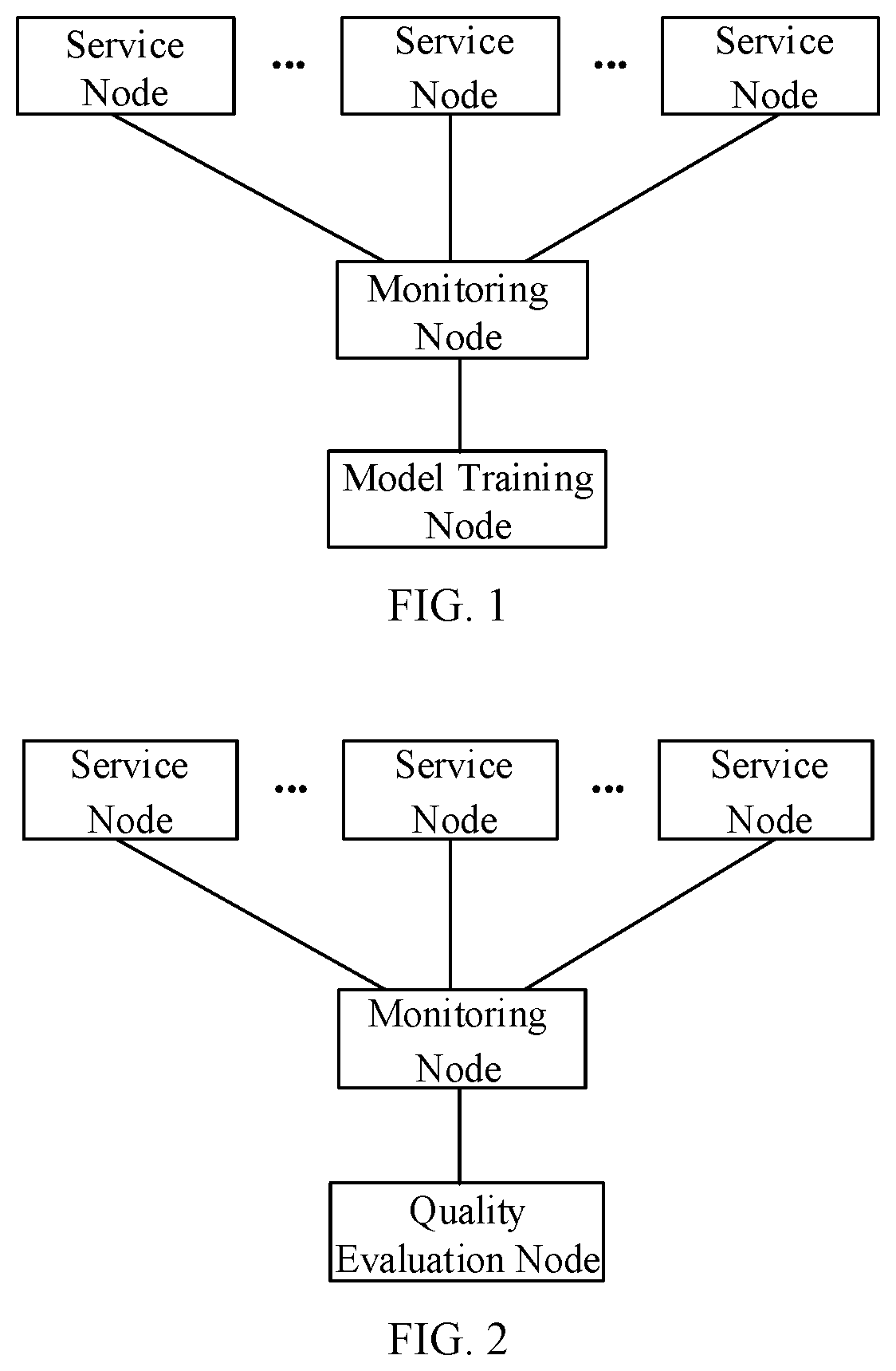

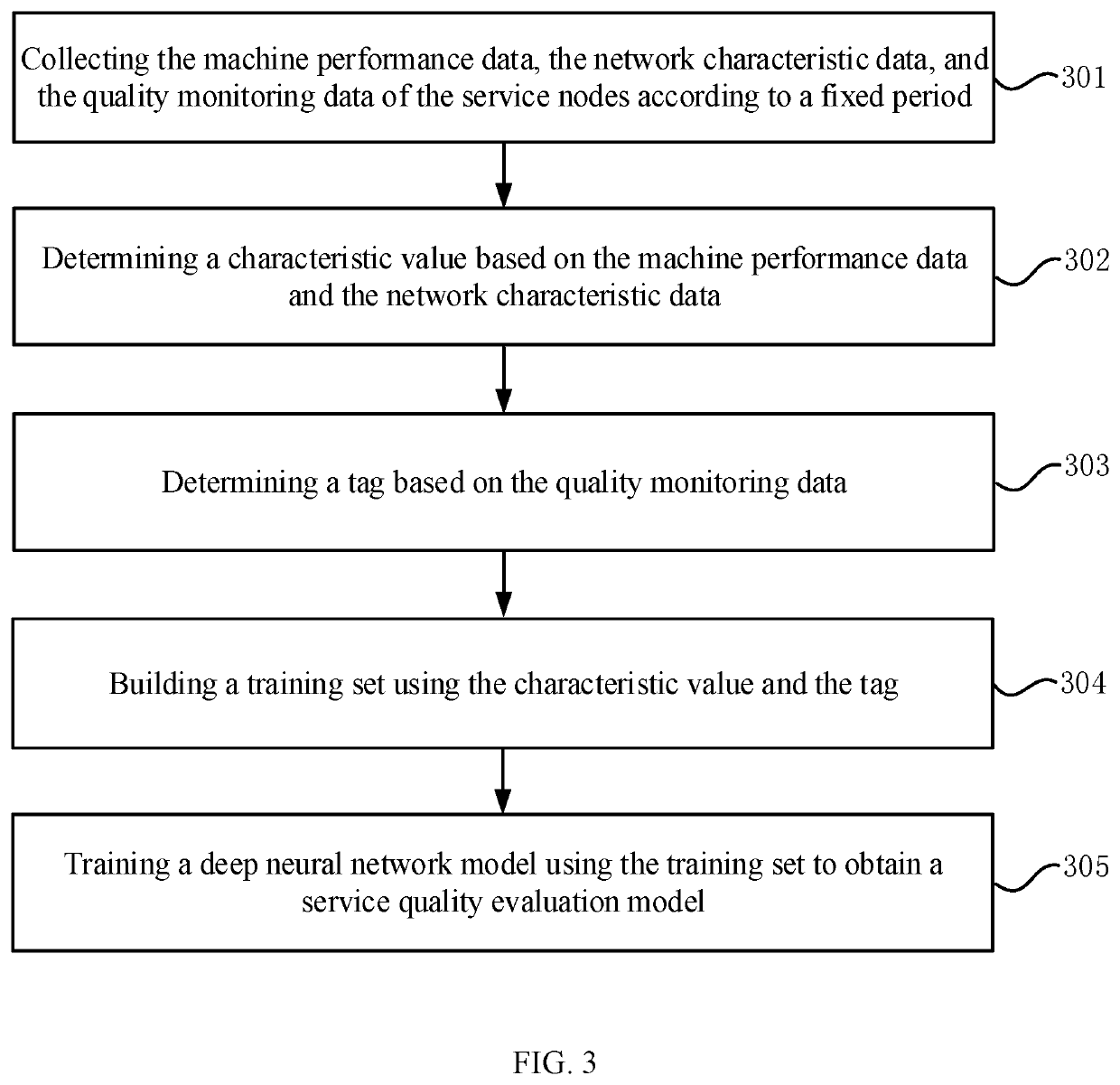

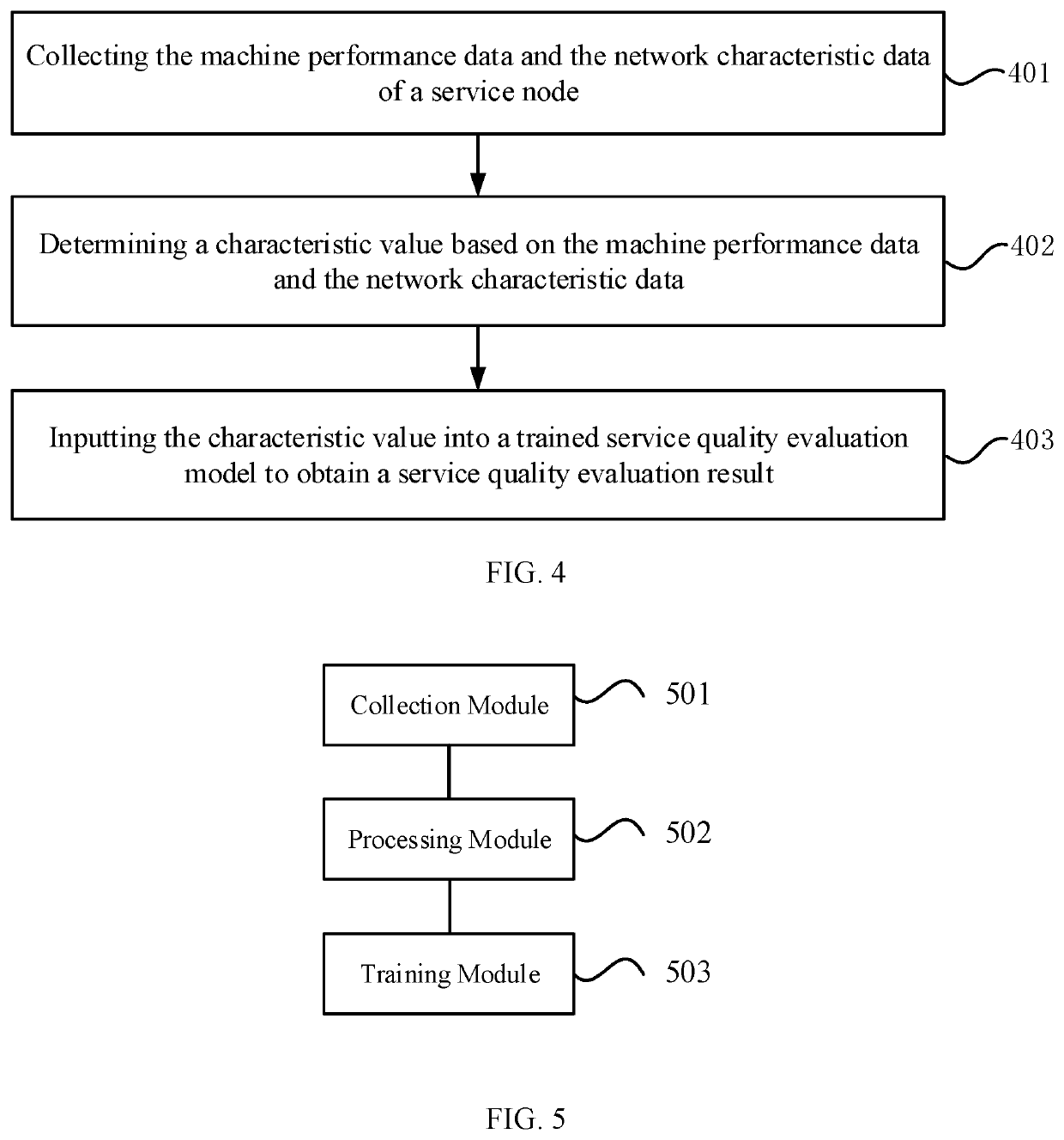

Training method and apparatus for service quality evaluation models

PendingUS20210027170A1Reduce operating costsImprove efficiencyNeural architecturesData switching networksQuality of serviceNeural network nn

Owner:CHINANETCENT TECH

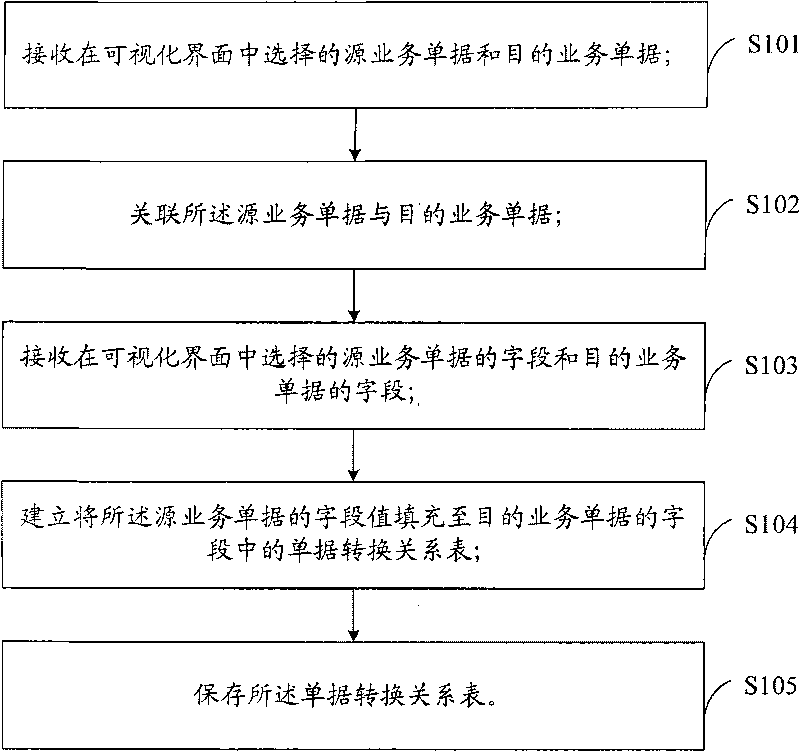

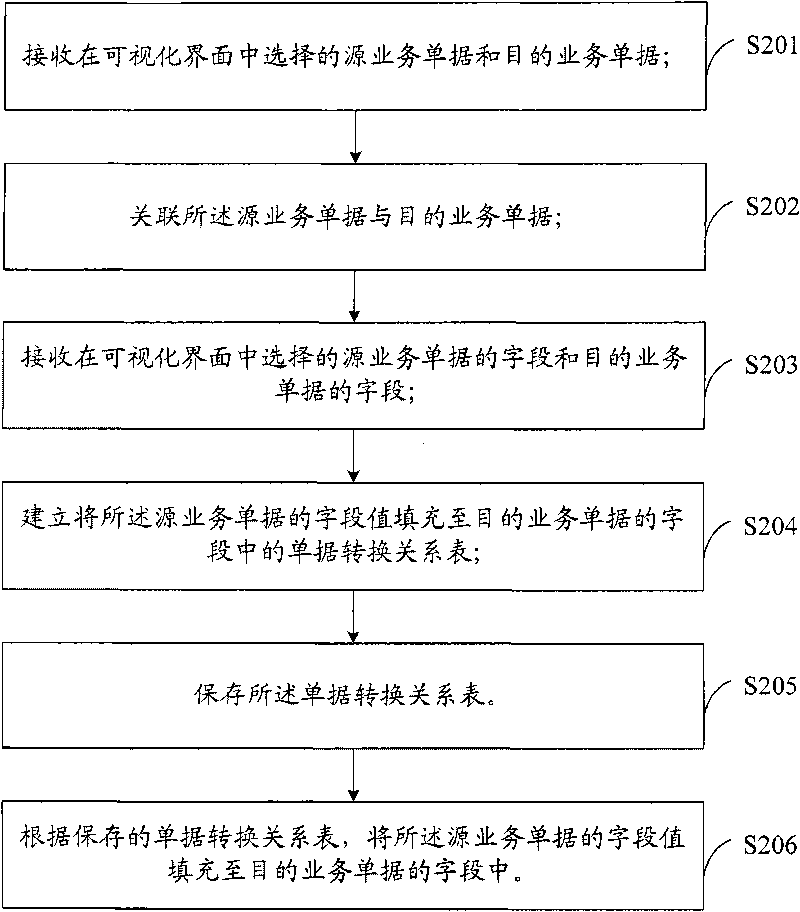

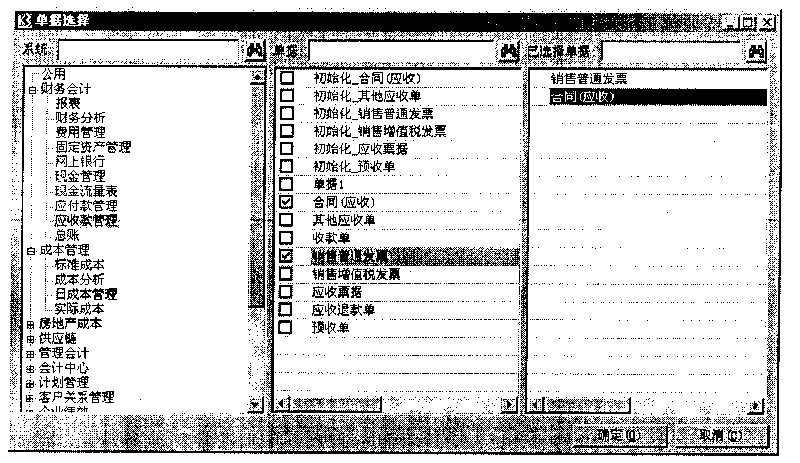

Conversion method for business document in ERP system, device and ERP system

InactiveCN101763585AIncrease flexibilityAchieve conversionResourcesDocument preparationVisual interface

The present invention provides a conversion method for business documents in an ERP system, device and ERP system, which is adequate for the technical field of data processing. The conversion method comprises the following steps of: receiving fields of source business documents and fields of destination business documents selected in a visual interface; establishing document transformational relation table that fills the fields of the source business documents into the fields of the destination business documents; and storing the document transformational relation table. The device consists of a field receiving module for receiving the fields of the source business documents and the fields of the destination business documents selected in a visual interface, a relation table establishing module for establishing the document transformational relation table that fills the fields of the source business documents into the fields of the destination business documents, and a storing module for storing the document transformational relation table. The method can add or modify the transformation of business documents by means of a visual interface, rapidly realize the transformation from one document to another document, improve the flexibility of ERP software, reduce data entry and improve work efficiency.

Owner:KINGDEE SOFTWARE(CHINA) CO LTD

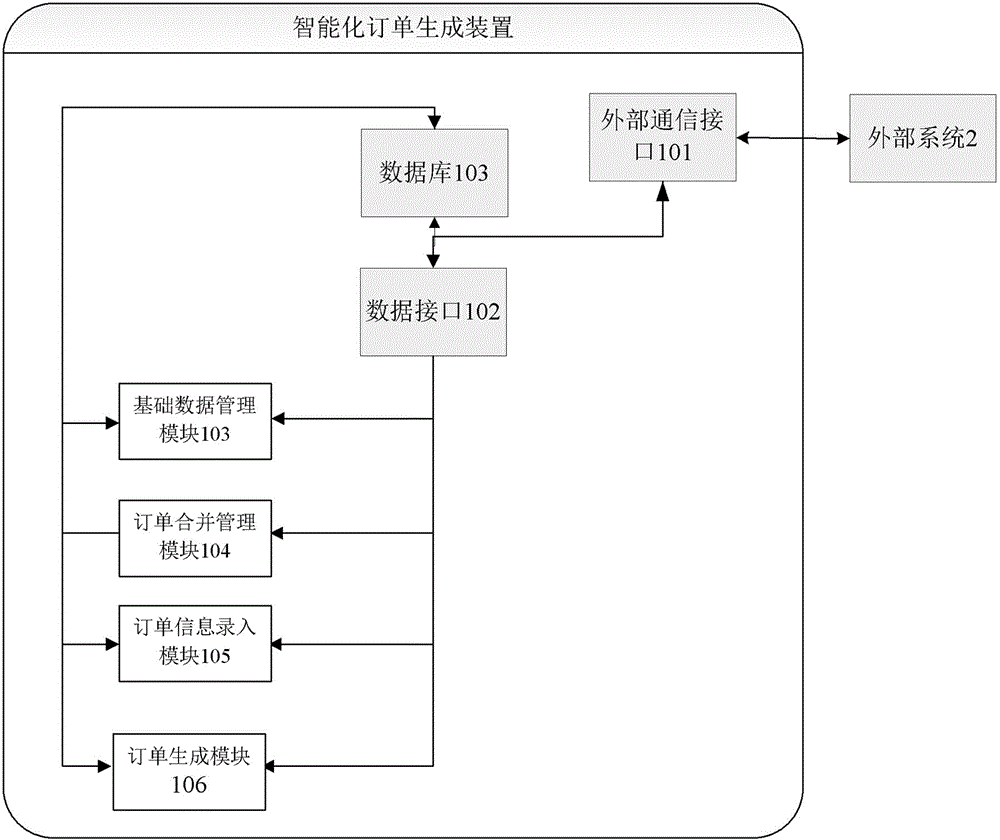

Intelligent order generation device and method

The invention discloses an intelligent order generation device and a method. Based on an intelligent ordering basic data table and intelligent order combination rules, a material-based intelligent ordering model is established. A purchaser inputs purchase material requirement information through an external system, and the device can automatically generate a purchase order according to rules. Automation of the whole ordering process is realized, and manual operation is minimized as much as possible. Ordering efficiency is raised, and order entry error probability is reduced. Meanwhile, purposes of reducing costs and controlling risks are also achieved.

Owner:GUANGZHOU BAOSTEEL SOUTHERN TRADING

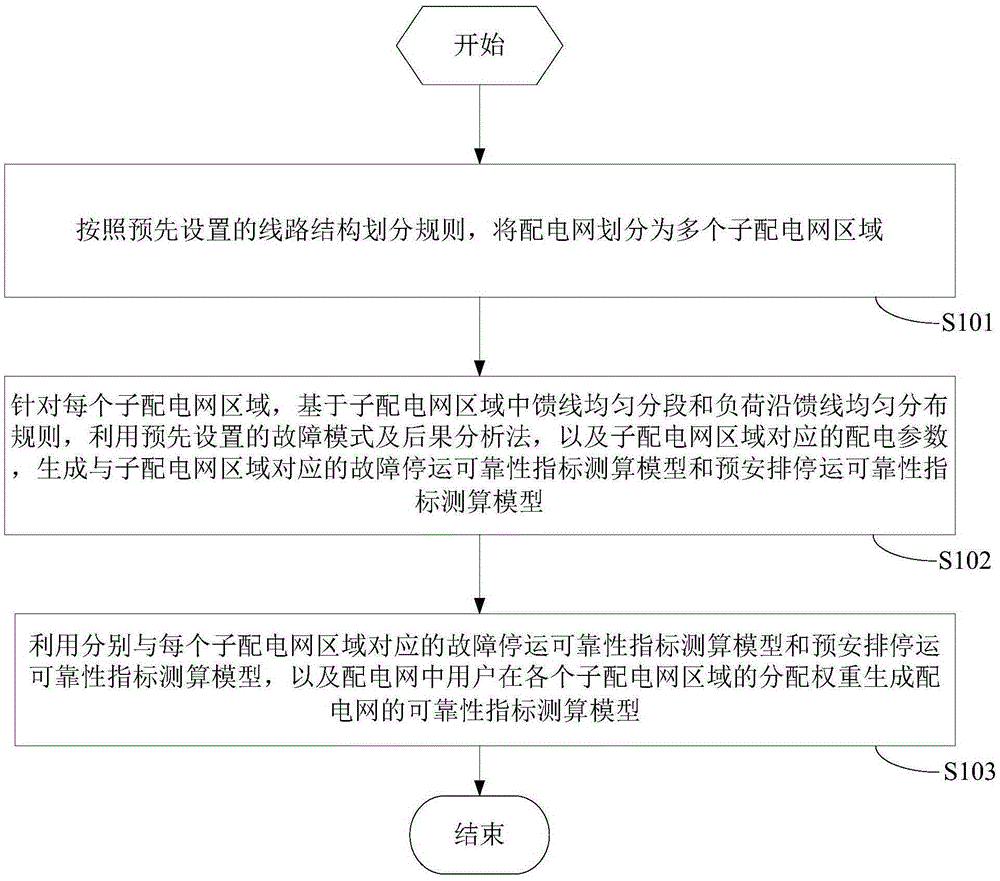

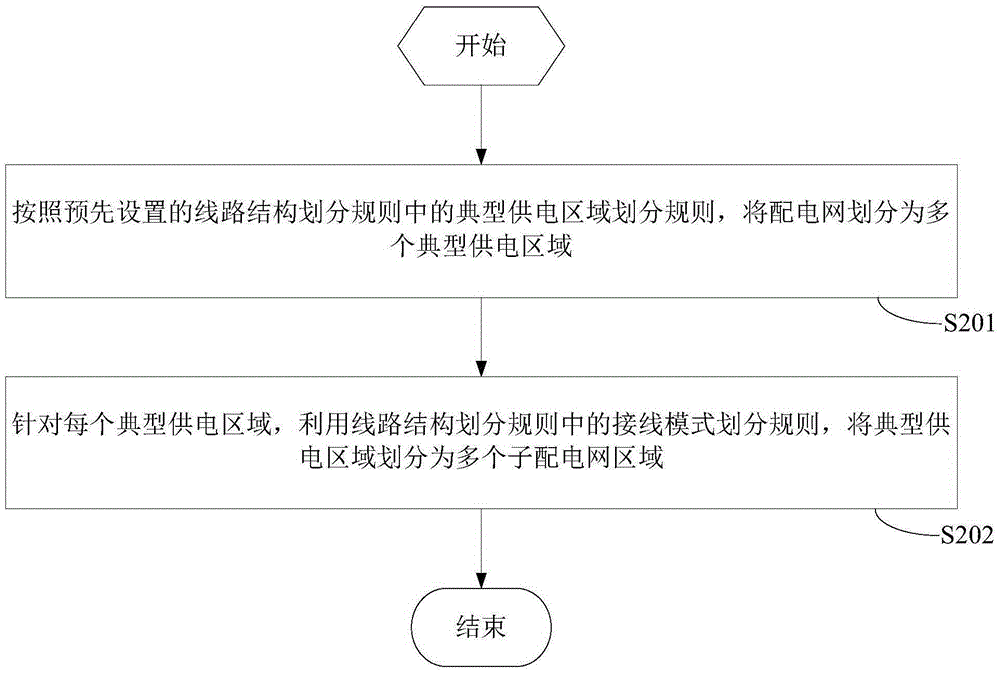

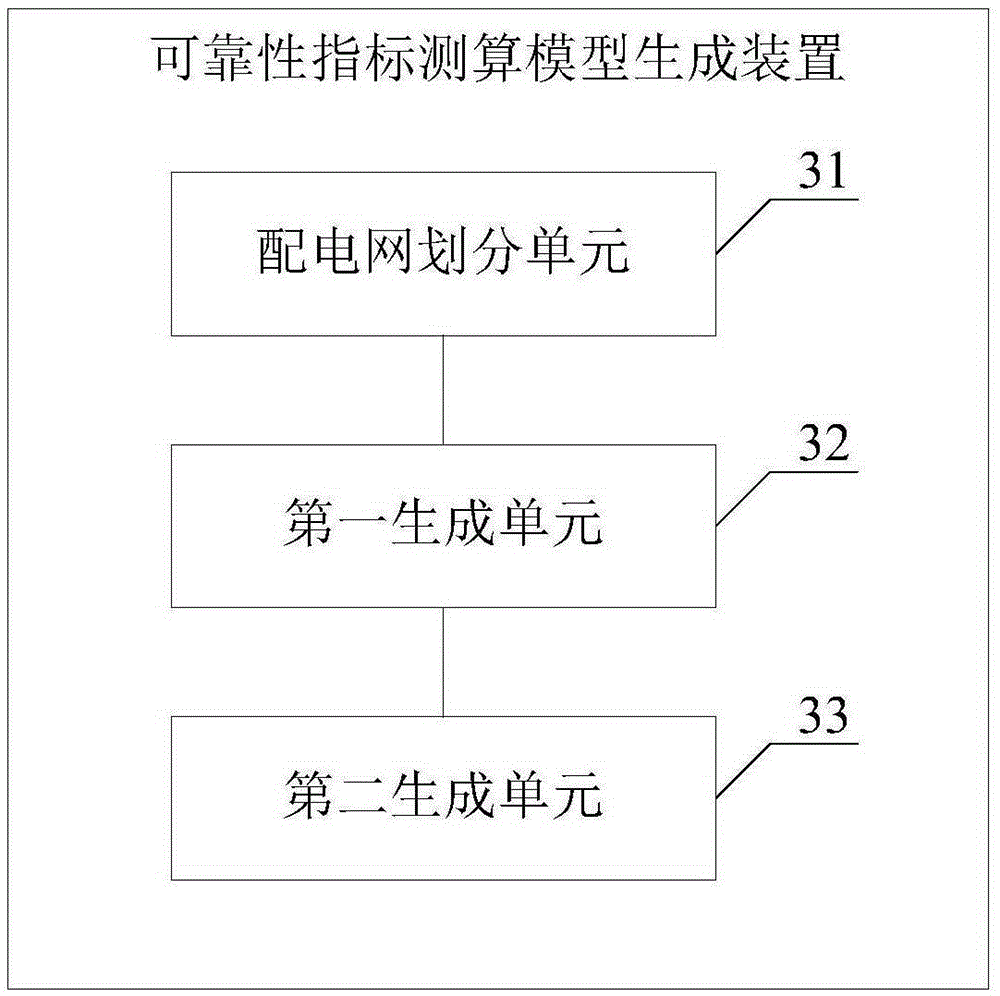

Reliability index measuring and calculating model generation method and apparatus and measuring and calculating method and apparatus

ActiveCN105356463AQuick calculationReduce data entryData processing applicationsContigency dealing ac circuit arrangementsDependabilityWorkload

The invention provides a reliability index measuring and calculating model generation method and apparatus and a measuring and calculating method and apparatus. The line structure of a power distribution network is divided into multiple sub-power distribution network areas; and a reliability index measuring and calculating model of the power distribution network is generated based on the rule that the feed lines in the sub-power distribution network areas are segmented uniformly and the load is in uniform distribution along the feed lines. Therefore, a user can measure and calculate the power distribution network reliability index without collecting and logging a network topology structure (i.e. information like distribution transform and switch position etc.) when measuring and calculating the reliability index by using the generated reliability index measuring and calculating model of the power distribution network; and the reliability index of the power distribution network is measured and calculated rapidly on the basis of reduction of data logging and data maintenance workload.

Owner:STATE GRID CHONGQING ELECTRIC POWER CO ELECTRIC POWER RES INST +2

Remote feature activator feature extraction

InactiveUS20100049725A1Significant laborReduce data entryDigital data processing detailsAnalogue secracy/subscription systemsFeature extractionDocument handling

A database record controls a license to use a computational component. An input receives an order identifier associated with an order related to a computational component and an interface retrieves order information associated with the identifier. The order information comprises at least one material code. A material code mapping agent compares the material code with at least one material code mapping table to identify corresponding computational component information associated with the material code. In another configuration, a transaction record includes first information associated with the order, the order relates to at least a first computational component and / or feature thereof, a configuration file includes second information different from the first information, the configuration file relates to at least one telecommunication switch / server, and a configuration file processing agent compares some of the first information with some of the second information to form a system record having both first and second information.

Owner:AVAYA INC

Systems, methods and computer program products for triggering multiple deep-linked pages, apps, environments, and devices from single ad click

ActiveUS10817914B1Improve conversion rateImprove system performanceAdvertisementsMobile appsWeb site

Embodiments disclosed herein can leverage dynamic data, fields and implied information from online media (e.g., web sites, mobile apps and other forms of online media) to create a universal variable map and automatically generate deep-linked ads utilizing the universal variable map, linking any arbitrary online media to any other arbitrary online media. The automatically generated deep-linked ads can be inserted into any ad server and served out from there in real-time. A deep-linked ad thus presented to a user can take the user from a starting page on one site or application where the ad is displayed directly to a resulting page such as a checkout page on another site or mobile application, with pertinent information already pre-populated, and action already initiated for the user.

Owner:METARAIL INC

Integrated insurance product quote system and method

InactiveUS20160371783A1Easy to understandReduce data entryFinanceDocumentation procedureRelevant information

An integrated quote system and method for generating quotes for multiple insurance products is disclosed. Quotes for multiple insurance products are integrated into a single, easy-to-read document. In an example embodiment, an agent enters a client's personal data into a quoting tool of an agent's workbench application. The client's data is automatically applied to every insurance product or plan the agent quotes for the client or client's family. Each quoted product is assigned a quote reference number and quotes for multiple products are linked using a quote identifier. A “recalculate” option updates any relevant calculations allowing the agent to review relevant financial details before generating a final quote. Products categories may be expanded or minimized as the agent navigates through insurance offerings so that only relevant information is displayed. Additional features and functionality support an online application process for each quoted product.

Owner:HUMANA INC

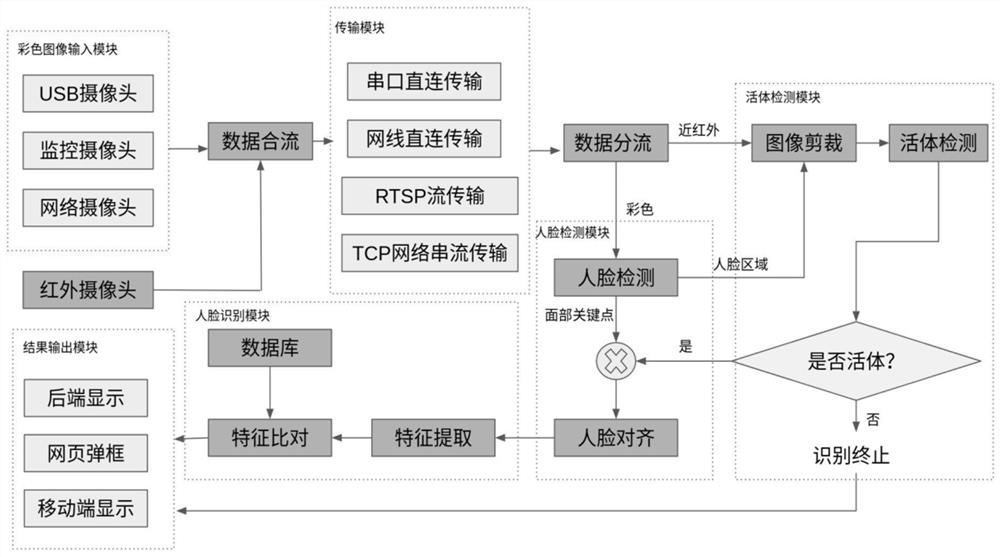

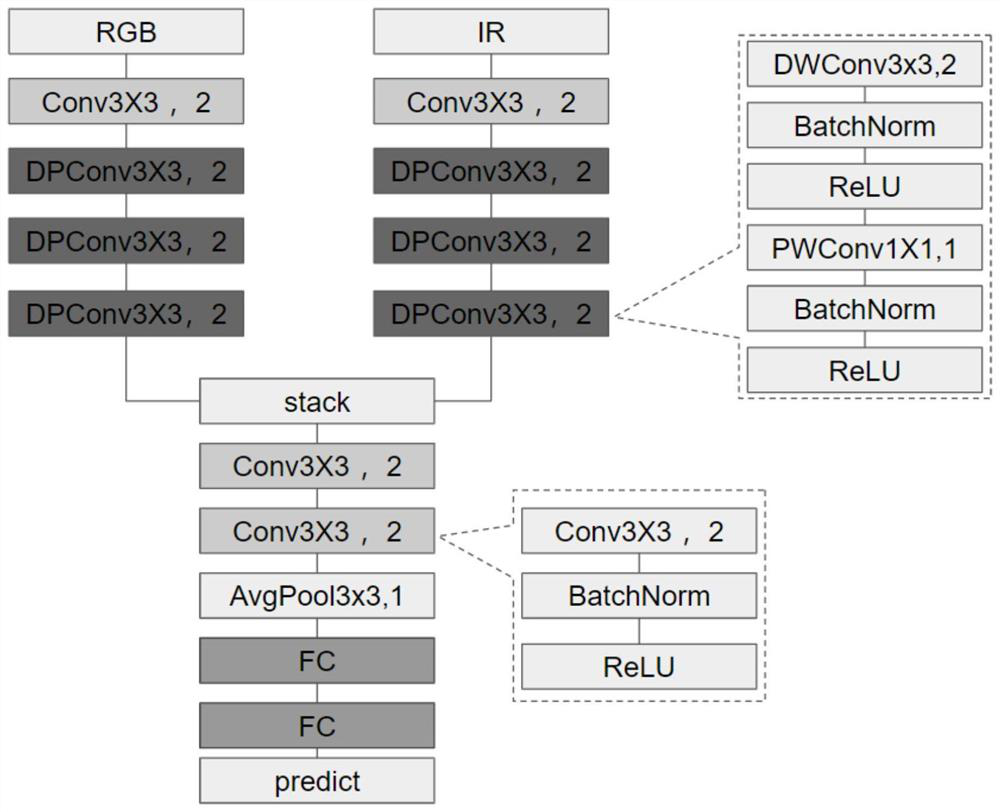

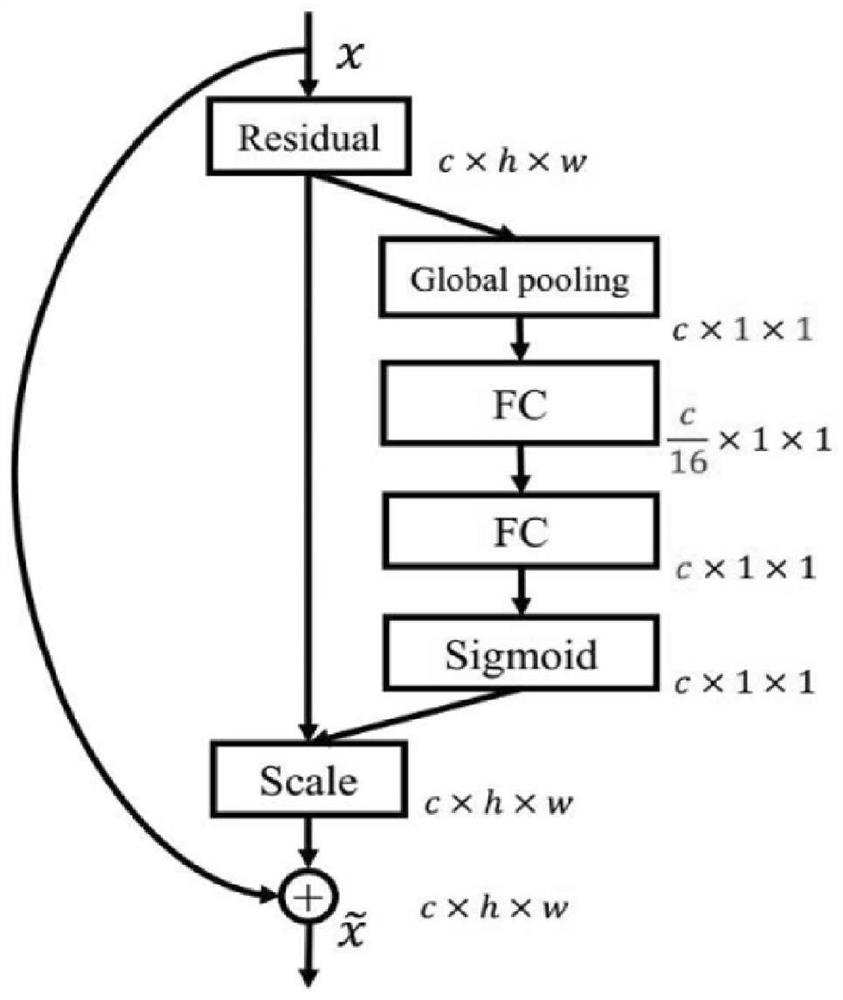

Modularized dynamic configurable living body face recognition system

ActiveCN112818722AReduce data entryImprove pass rateSpoof detectionEnergy efficient computingFace detectionEngineering

The invention relates to a modularized dynamic configurable living body face recognition system, which comprises an image input module, a transmission module, a living body detection module realized by adopting a fusion feature convolutional network, a face detection module realized by adopting a face feature extraction convolutional neural network, a face recognition module and a result output module. Under different illumination intensities, a higher face recognition result is obtained, and under the conditions of no light, weak light and normal light sources, the feature fusion network has high robustness and high accuracy.

Owner:SHANGHAI UNIV

A system for automatic management and proces of knitting proces is disclosed

PendingCN109508876AEasy operation and entryImplement system managementResourcesManufacturing computing systemsProcess systemsYarn

The invention relates to an automatic management and processing system for knitting process, which is formed by building a weaving process system, building a laboratory management system, building a dyeing process system, building a post-whole process system, building a butt joint system and building a maintenance system. The invention has the advantages that the knitting process system platform is established, the operation and input of the process personnel are convenient, the graphical needle arrangement and the graphical color stripe arrangement can be realized, and the yarn quantity usedby the system is automatically calculated.

Owner:NANTONG TIMES CLOTHING

Automated healthcare cash account reconciliation method

ActiveUS10586019B1Facilitate cash account reconciliationFacilitating reconciliationFinancePayment architectureBank accountEngineering

A system and method for reconciling a healthcare payment account includes receiving: (a) a first file that includes sorted and rebalanced explanation of benefits information from a healthcare payer, the first file generated by segregating comingled data for multiple healthcare providers or accounting systems; (b) a second file that includes payment information for a bank account of a healthcare provider; and, (c) a third file that includes accounting information from the healthcare provider; using reassociation and file splitting processes to match transactions of at least two files using rules based logic, and to calculate variances of transactions between at least two files; and, displaying at least one of variance via at least one GUI to facilitate reconciliation.

Owner:THE PNC FINANCIAL SERVICES GROUP

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com