Patents

Literature

192 results about "Advance payment" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

An advance payment, or simply an advance, is the part of a contractually due sum that is paid or received in advance for goods or services, while the balance included in the invoice will only follow the delivery. Advance payments are recorded as a prepaid expense in accrual accounting for the entity issuing the advance. Advanced payments are recorded as assets on the balance sheet. As these assets are used they are expended and recorded on the income statement for the period in which they are incurred. Insurance is a common prepaid asset, which will only be a prepaid asset because it is a proactive measure to protect business from unforeseen events.

Method and apparatus for distributing currency

InactiveUSRE37122E1Improve securityComplete banking machinesCredit registering devices actuationElectronic accessComputer terminal

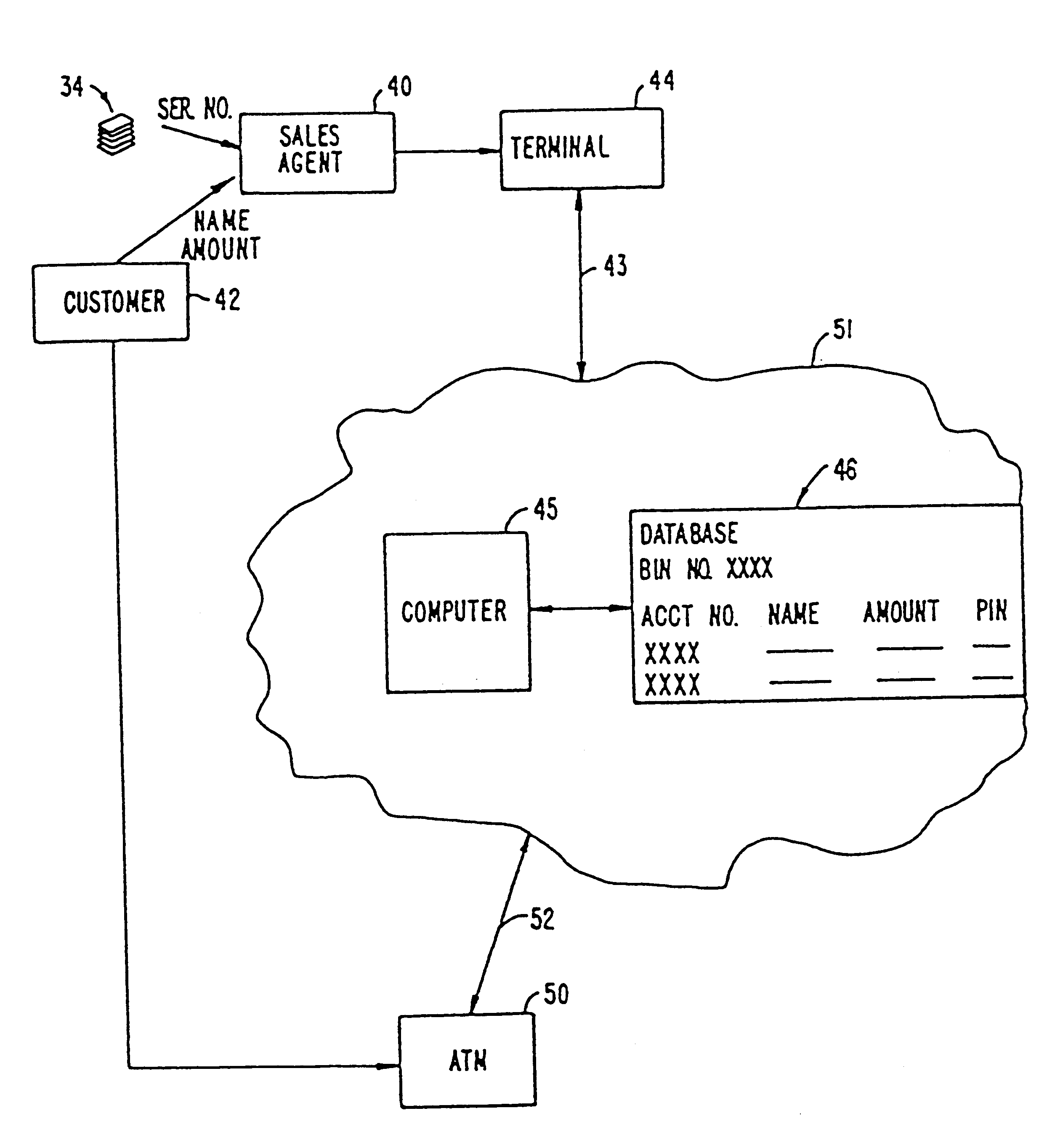

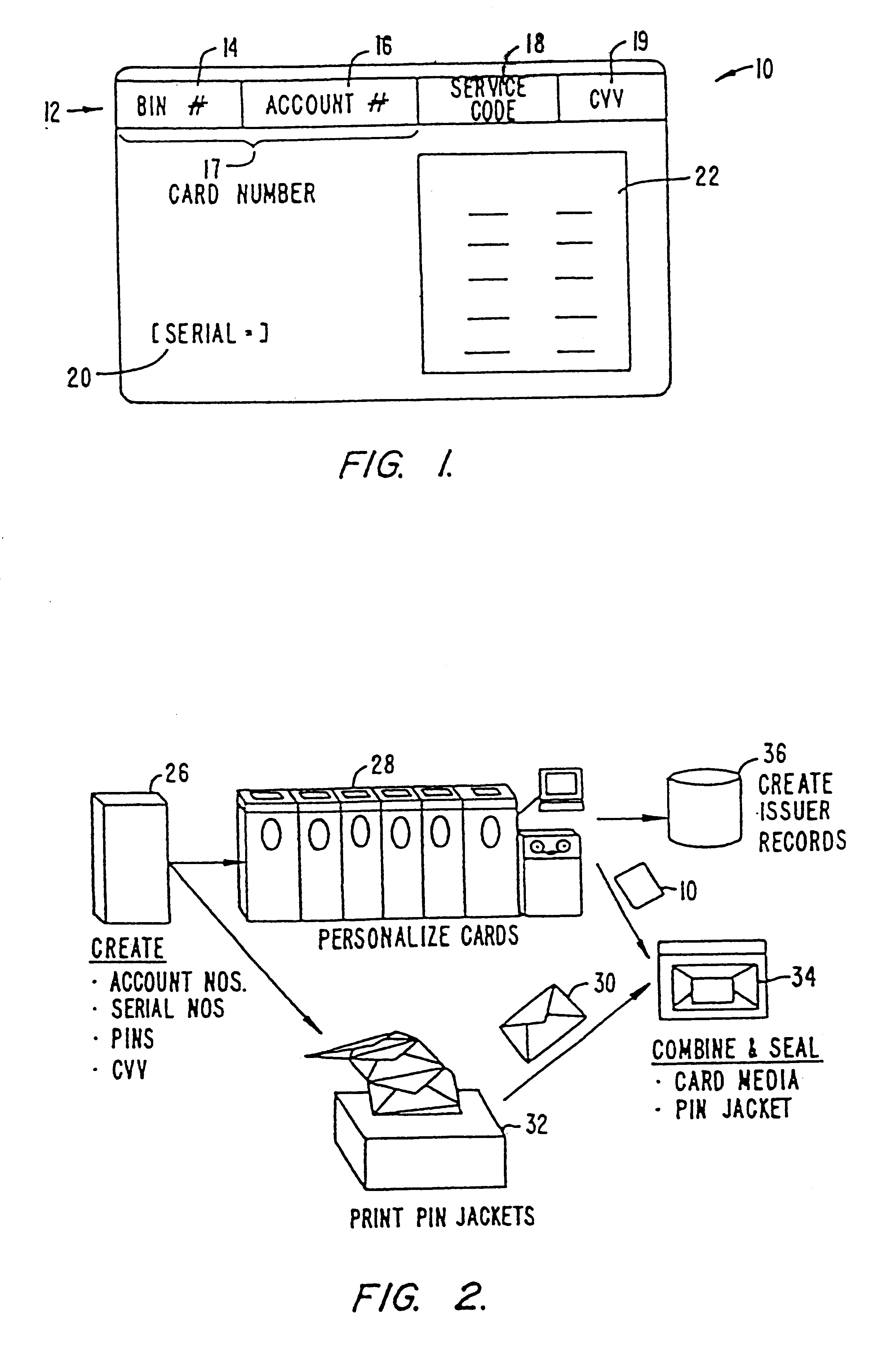

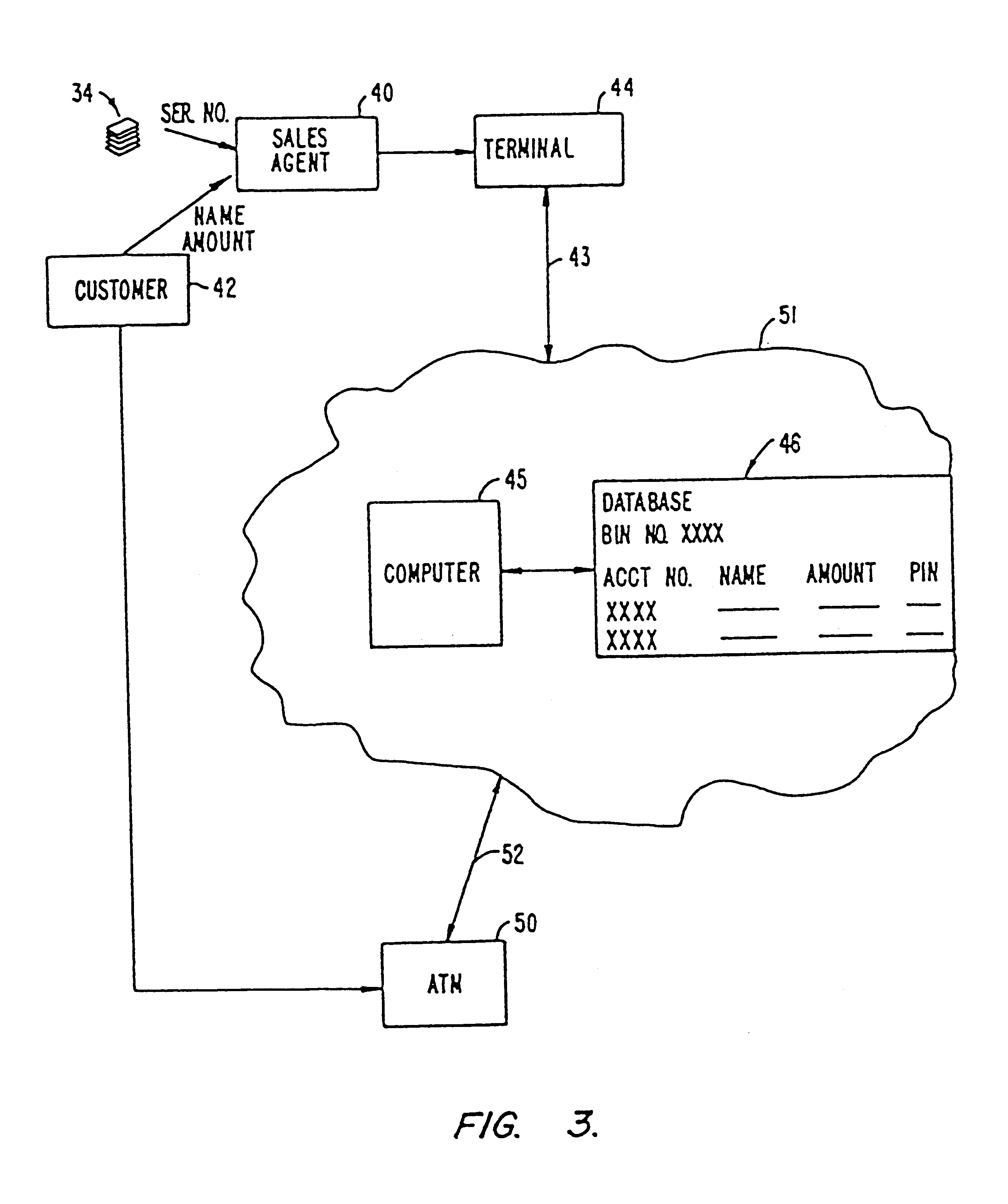

A process which provides electronic access to pre-paid funds for cash or payment for goods and services. A card is issued to a customer with a value selectable by the customer. The card has a magnetic stripe with an encoded card number including a bank identification number (BIN) and an account number. The central card processor establishes a zero balance database including the card numbers, but with blank fields for the customer data and the value of the account. When a customer purchases a card, the sales agent transmits to the central database computer which fills in the blanks in the database, activating the account, and transmits an acknowledgement signal back to the sales agent. The customer can immediately use the card in ATM or other remote terminals to acquire cash or purchase goods and services. The customer inputs a PIN number which is provided with the card, or a customer selected alternative PIN number.

Owner:VISA INT SERVICE ASSOC

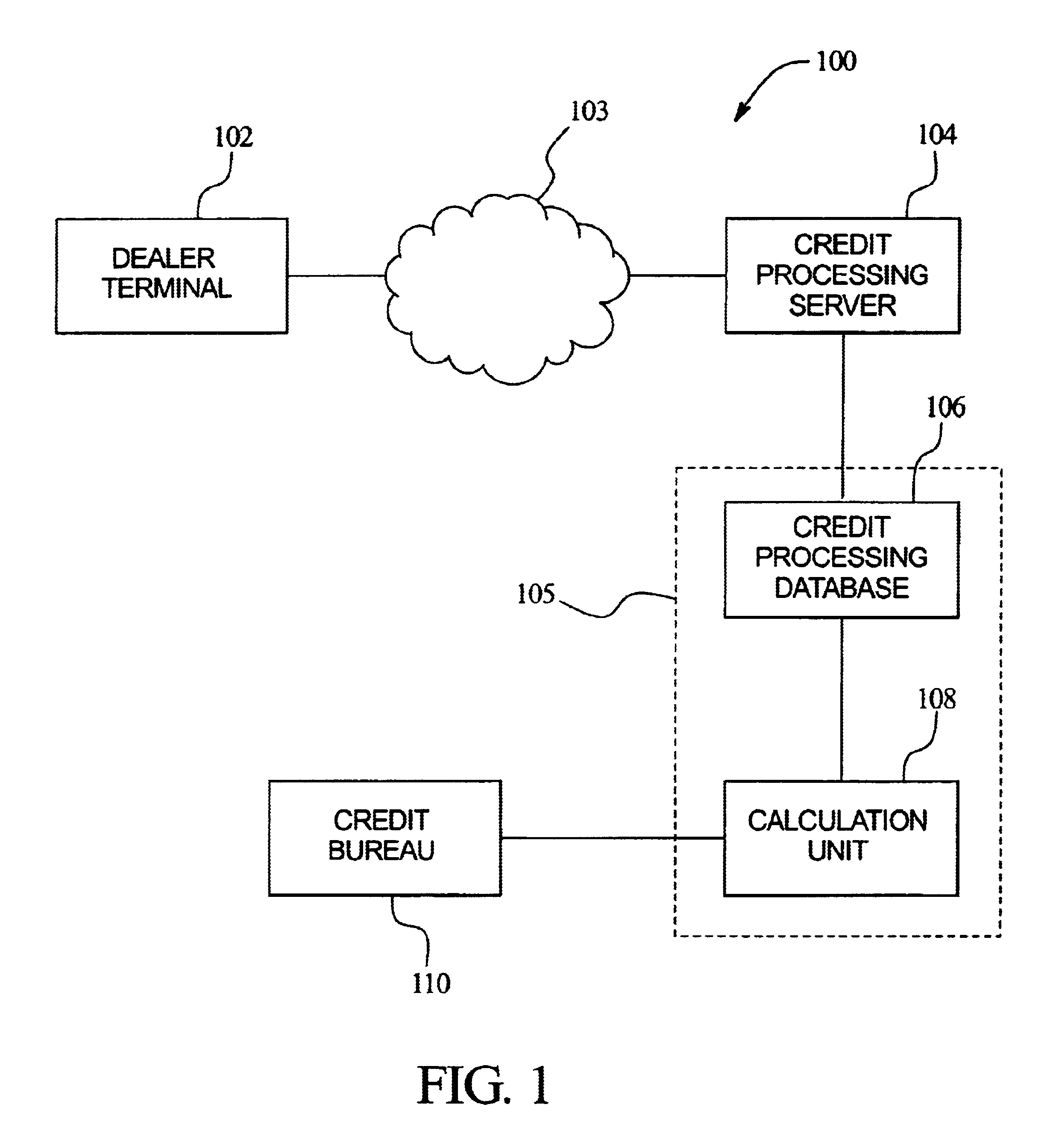

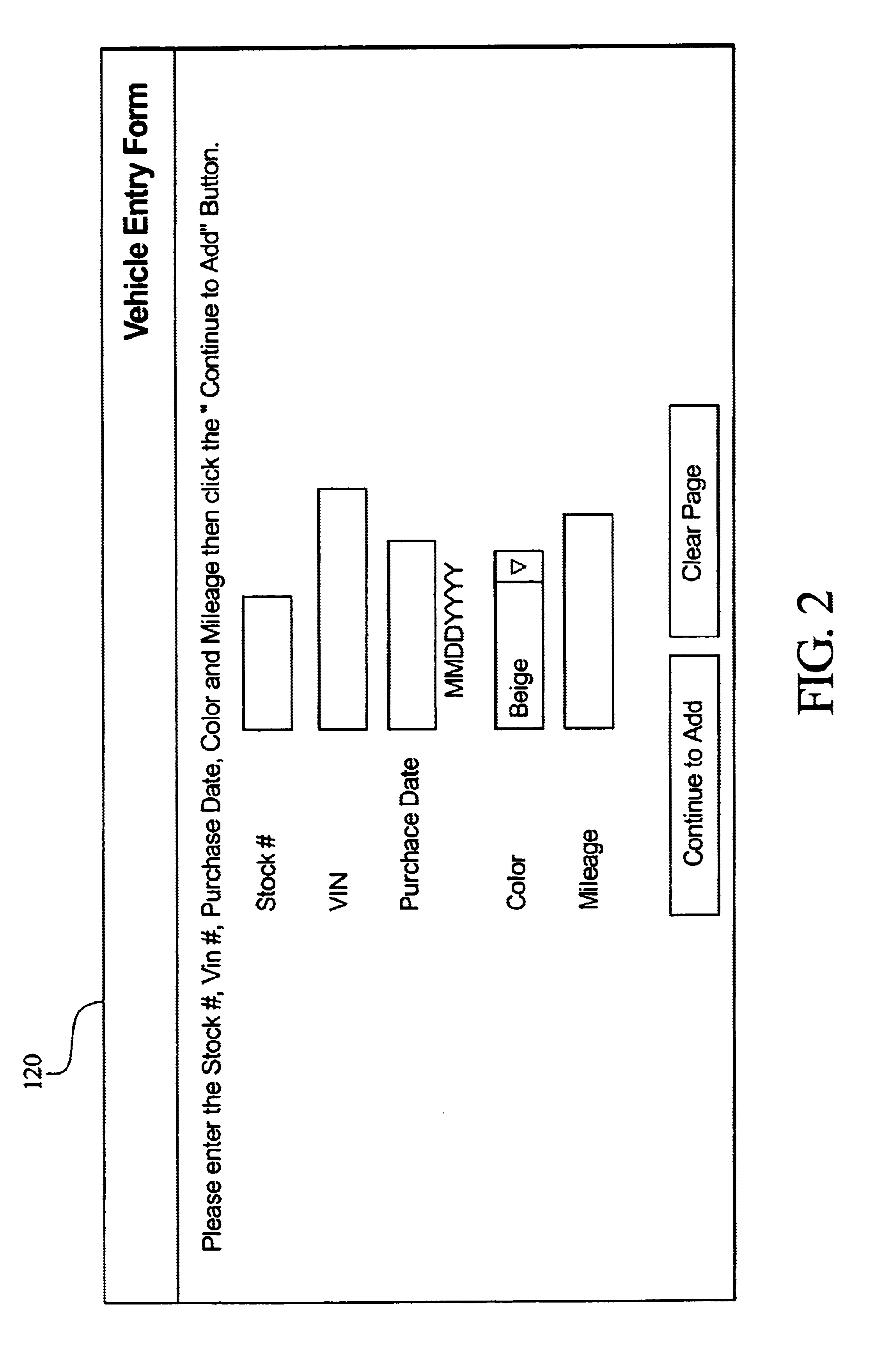

System and method for providing financing

InactiveUS6950807B2Easy to identifyQuickly and efficiently exploredFinanceBuying/selling/leasing transactionsComputer scienceOperations research

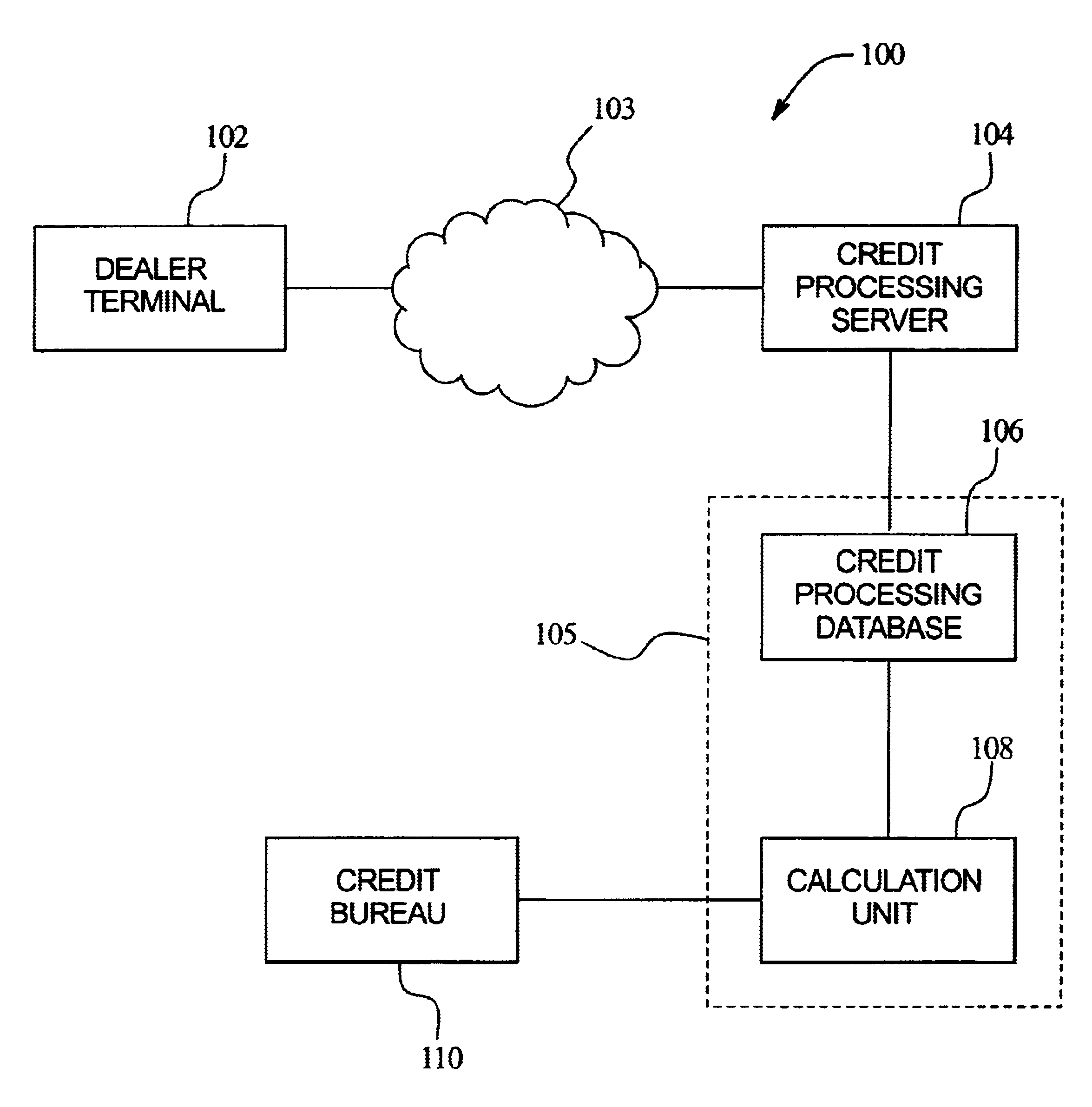

A method of providing financing is provided. The method provides financing for allowing a customer to purchase a product selected from an inventory of products maintained by a dealer. The method includes the steps of maintaining a database of the dealer's inventory, gathering information from the customer, calculating a credit score for the customer based at least in part on the information gathered from the customer, determining an advance amount to be paid to the dealer for each individual product in the dealer inventory in the event that that particular product is sold to the customer, calculating a front-end profit to be realized by the dealer for each individual product in the dealer inventory, and presenting a financing package to the dealer for each individual product in the dealer's inventory.

Owner:CREDIT ACCEPTANCE CORP

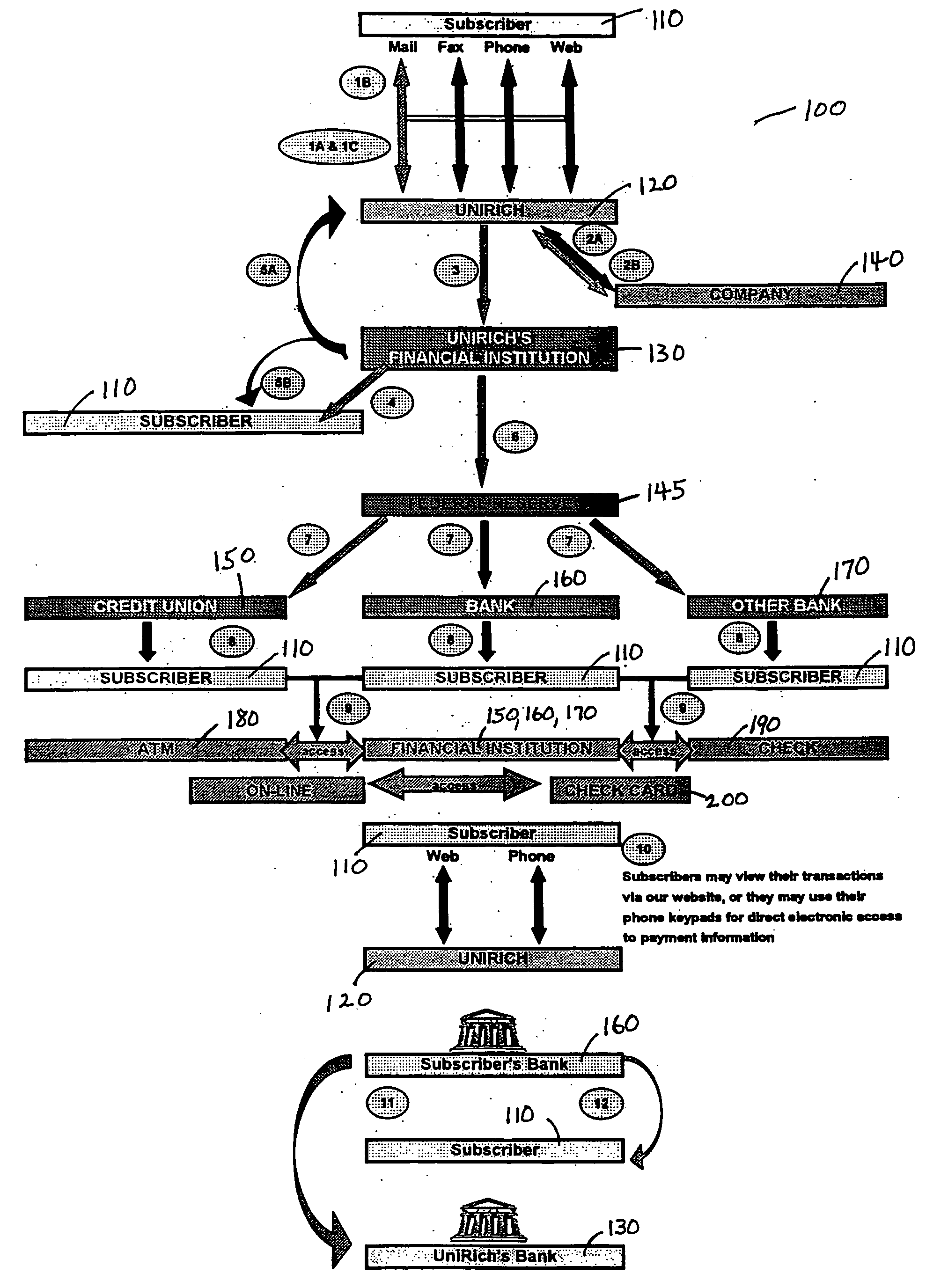

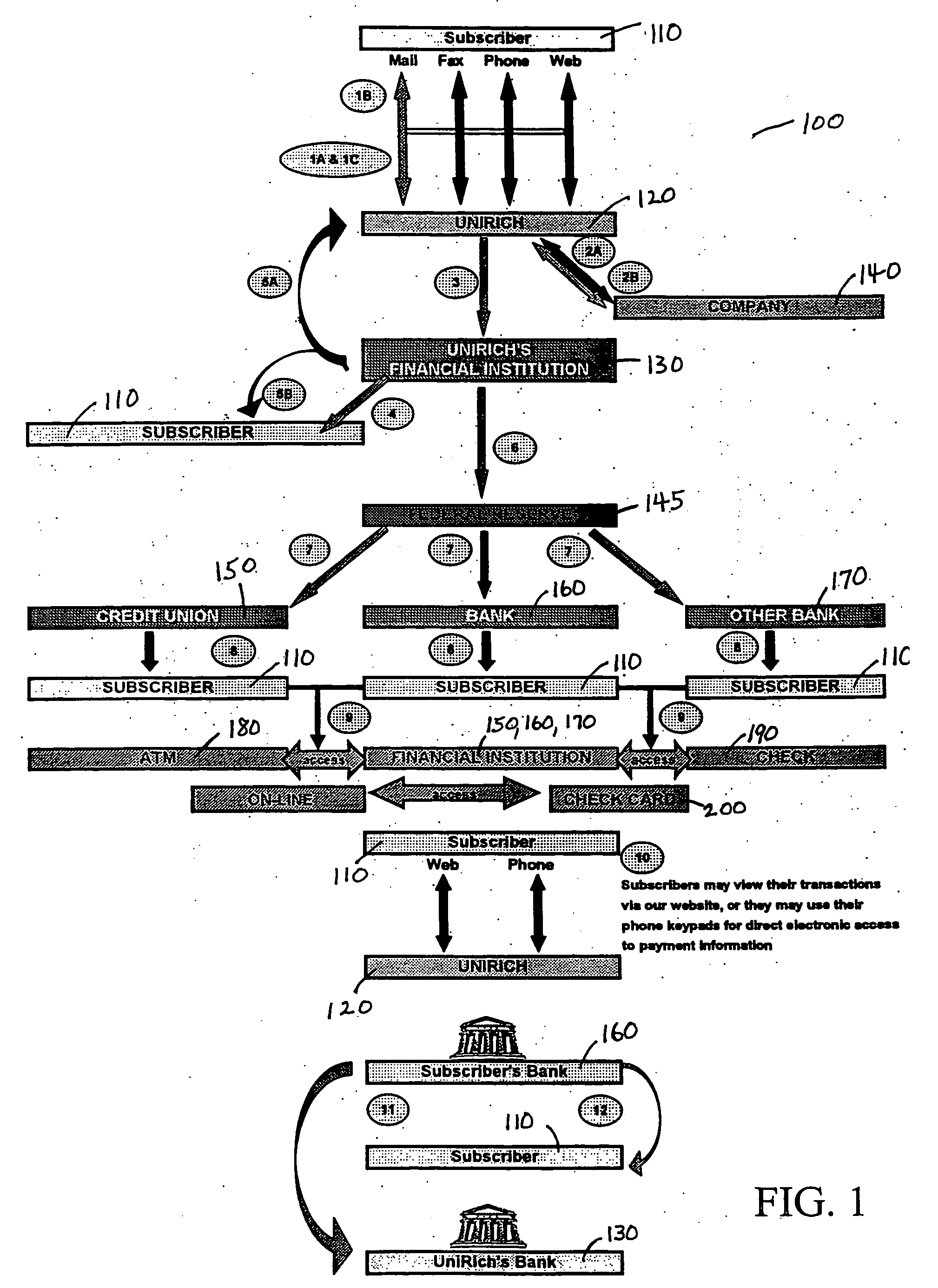

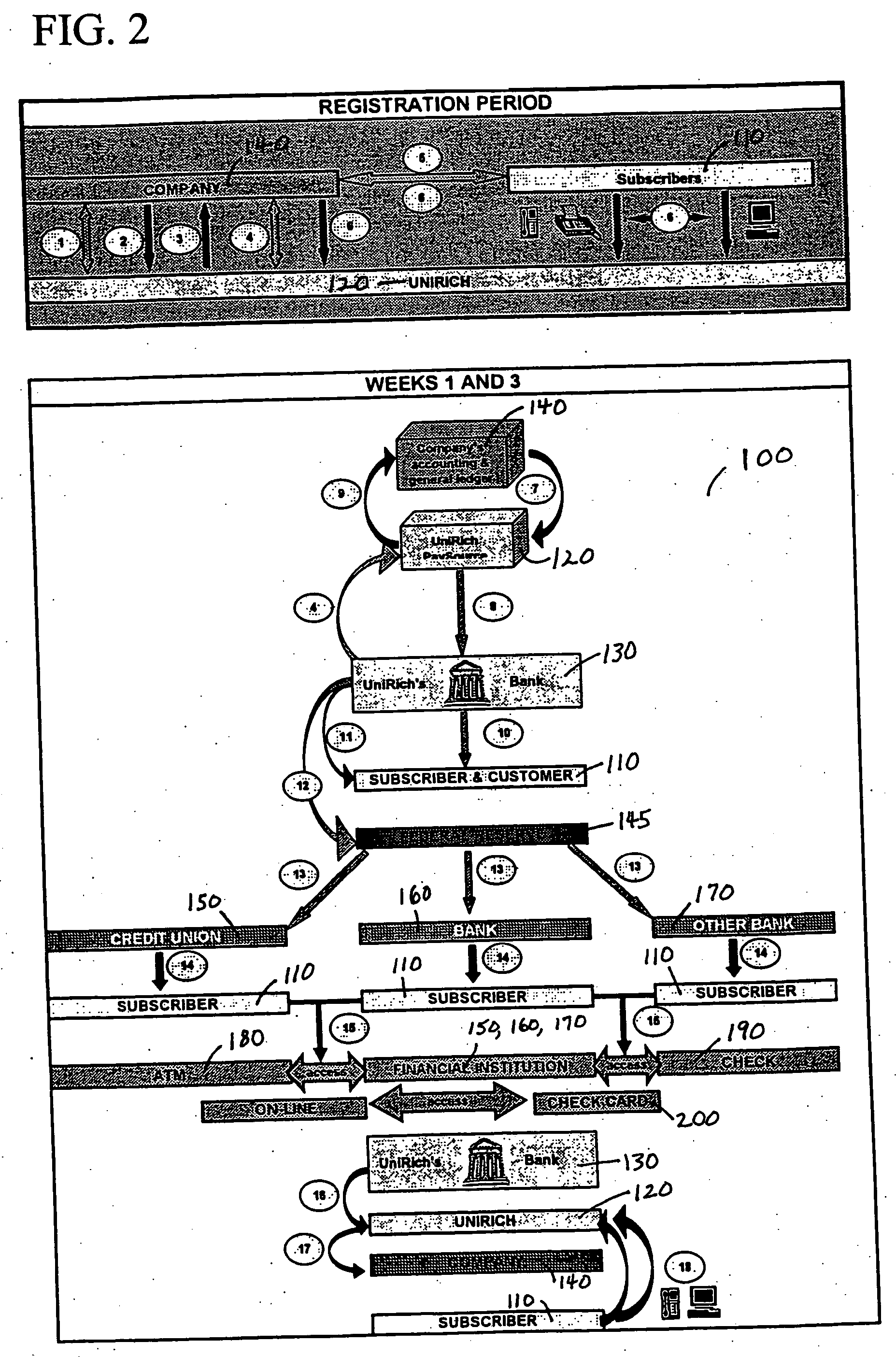

Computerized system and method for an automated payment process

A computerized payment system and method is disclosed which provides subscribers with funds based on their income at regular, pre-defined intervals other than those on which they are normally paid. In so doing, it interfaces with the subscriber or with the subscriber and his source of income, and utilizes a computer network to electronically transfer funds and record transactions. Payments may be made with either net pay, or net pay less deductions; may be of advances or distributions; and may be of either fixed or variable amounts.

Owner:UNIRICH

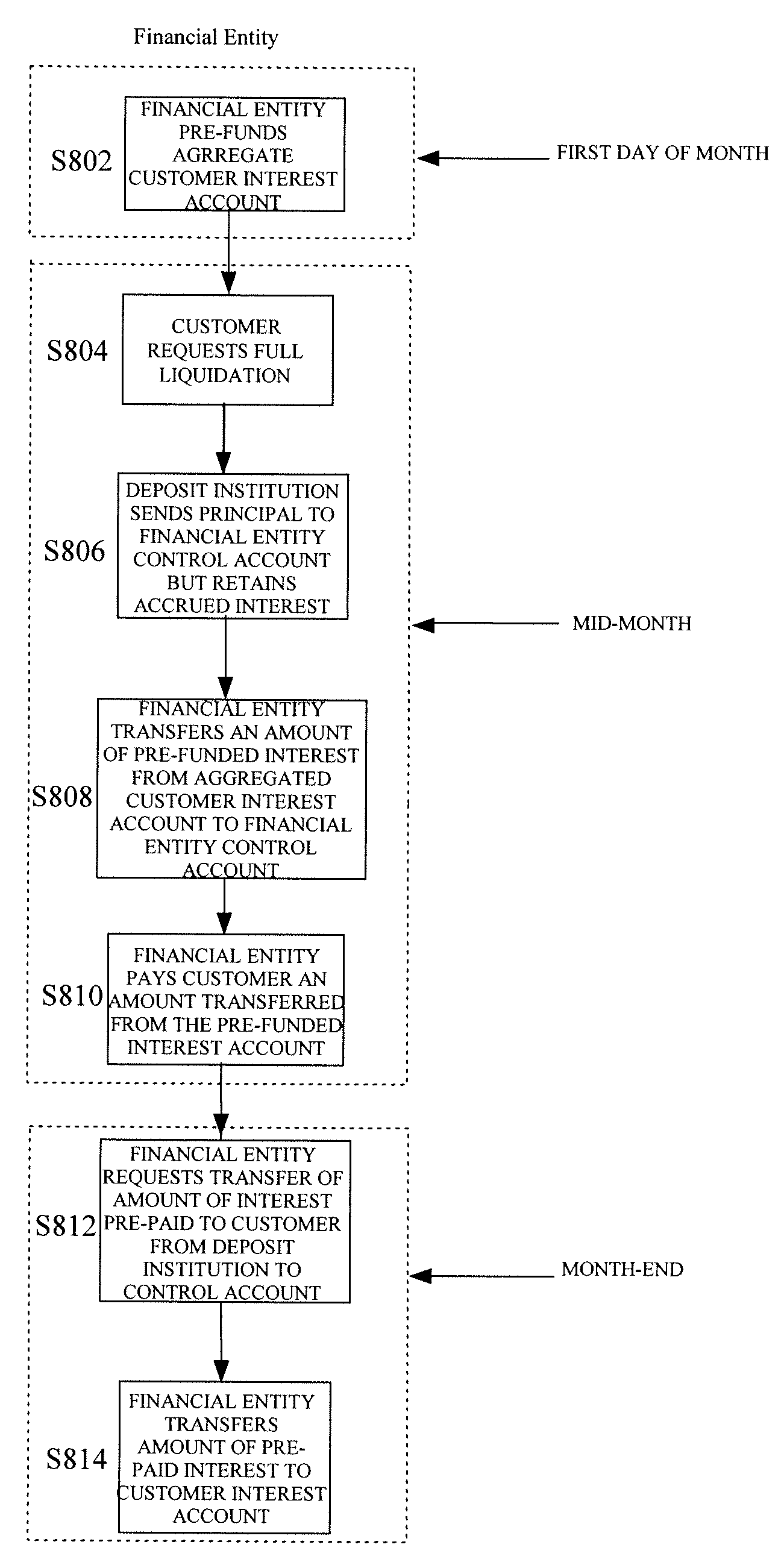

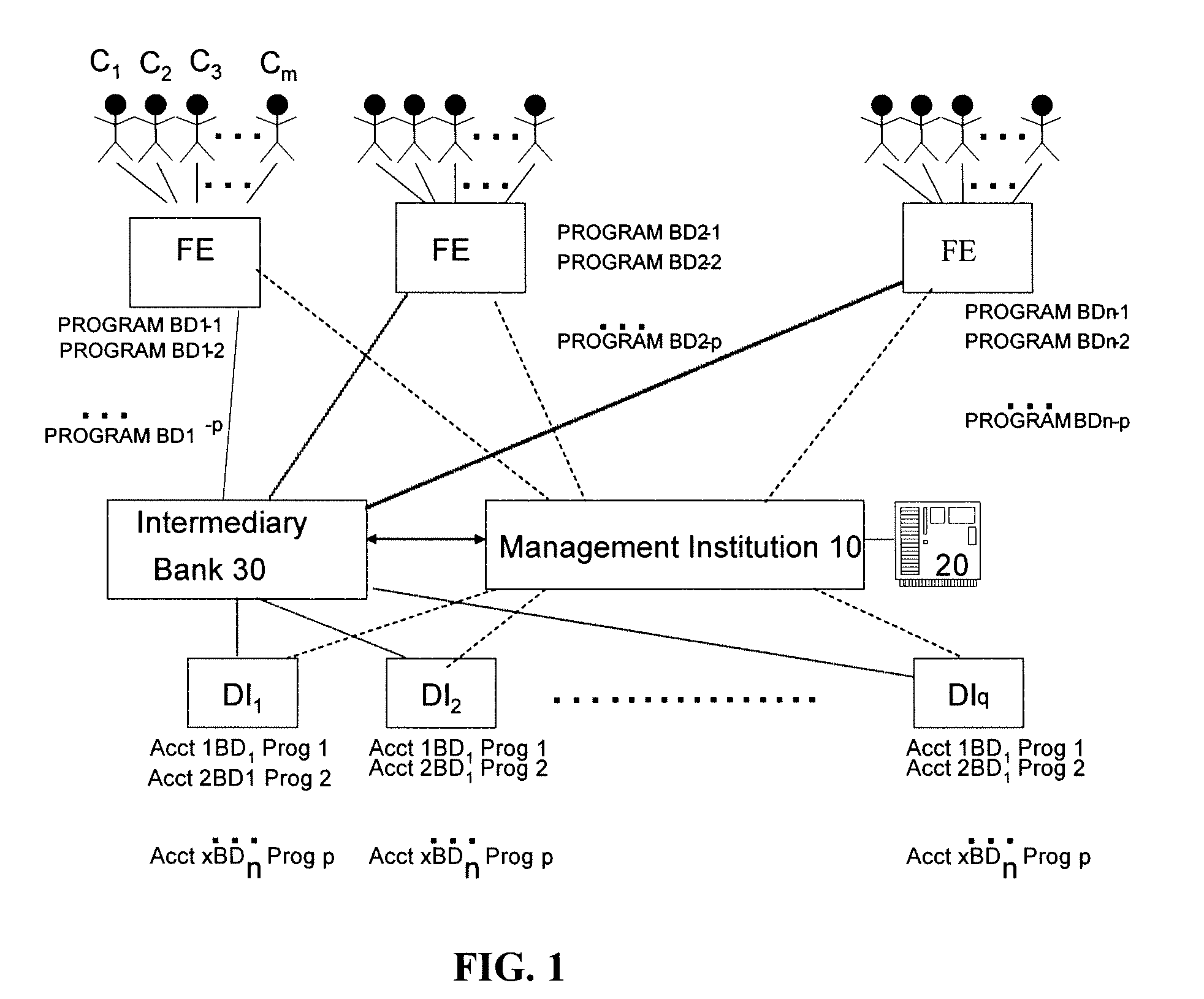

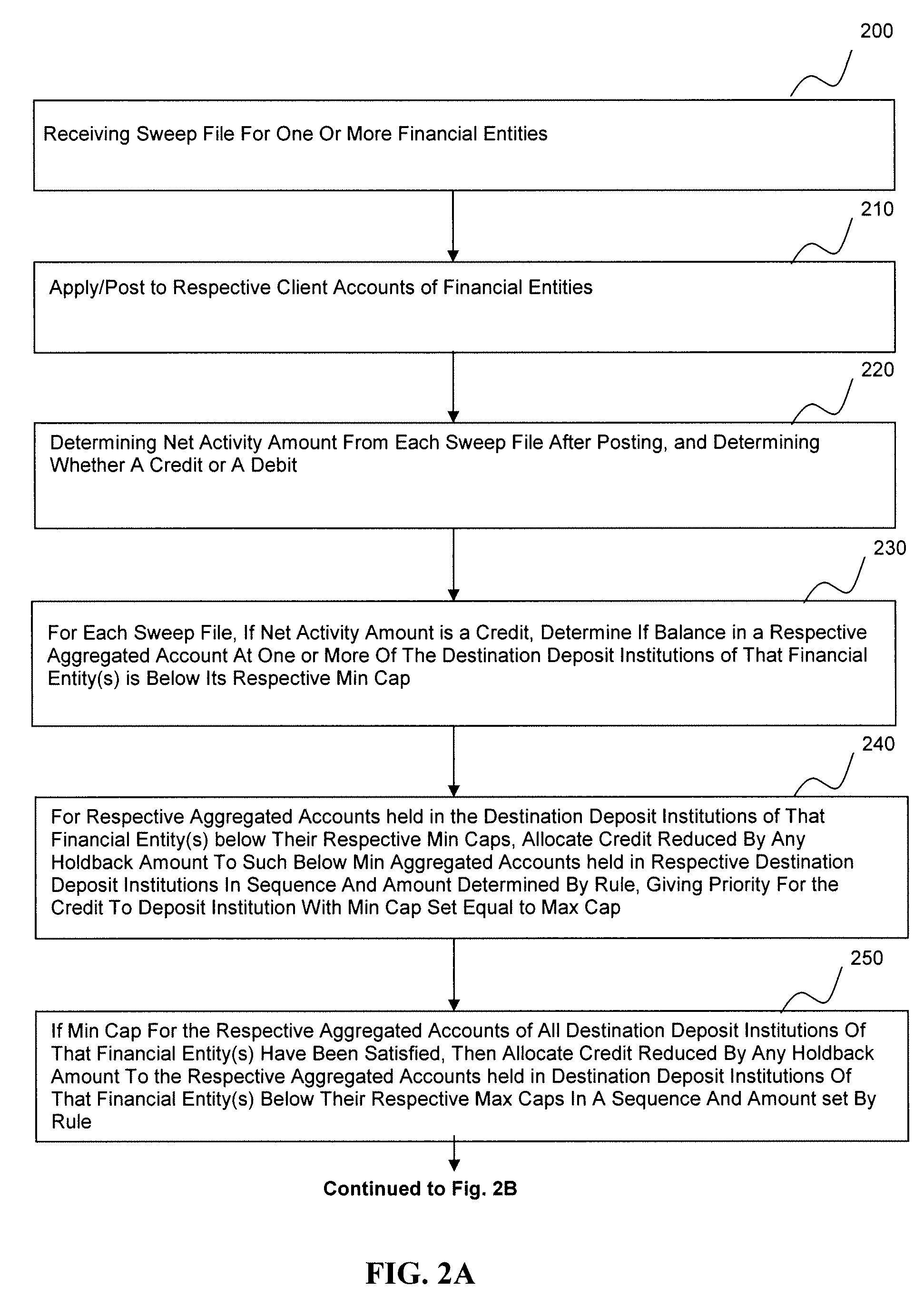

System and method for pre-funding interest for early termination of client account having funds in one or more aggregated accounts

A method, program product and system for pre-funding interest in the process of managing a group of aggregated accounts, each aggregated account held in a different one of a plurality of deposit institutions, each of the aggregated accounts associated with at least one financial entity and holding funds of a plurality of clients of the at least one financial entity, each of the clients having a client asset balance in a respective client account associated with the at least one financial entity, the method comprising: (a) receiving or calculating a pre-funding amount for interest for one or more client accounts; (b) receiving access to or obtaining control over funds for the pre-funding amount; (c) receiving information about a termination of a given client account with funds held in the one or more aggregated accounts prior to an end of an interest period; (d) receiving or calculating an interest payment due to the client account for the client asset balance; and (e) transferring before the end of the interest period an amount from the funds for the pre-funding amount to satisfy the interest payment due for the one or more aggregated accounts.

Owner:ISLAND INTPROP

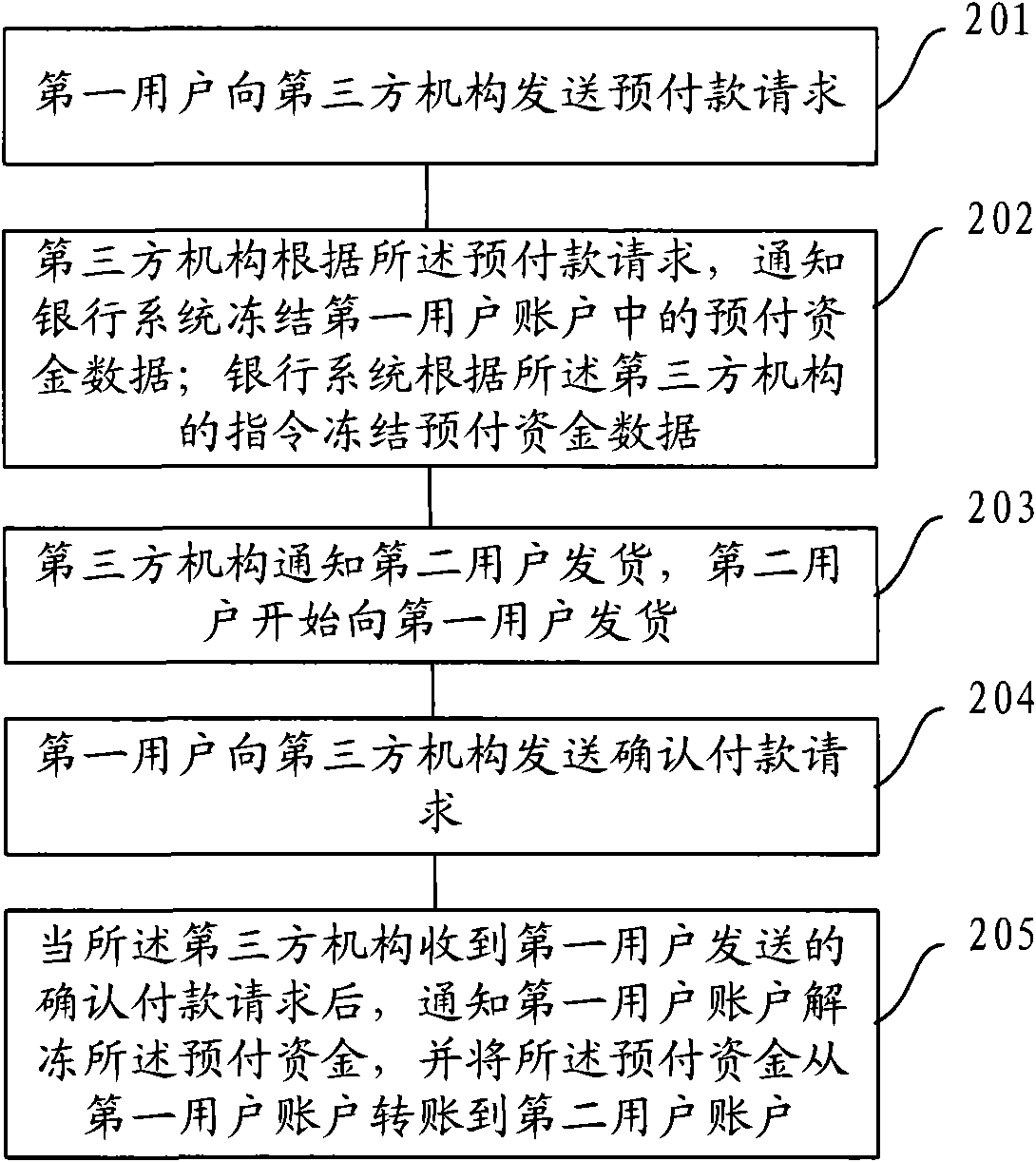

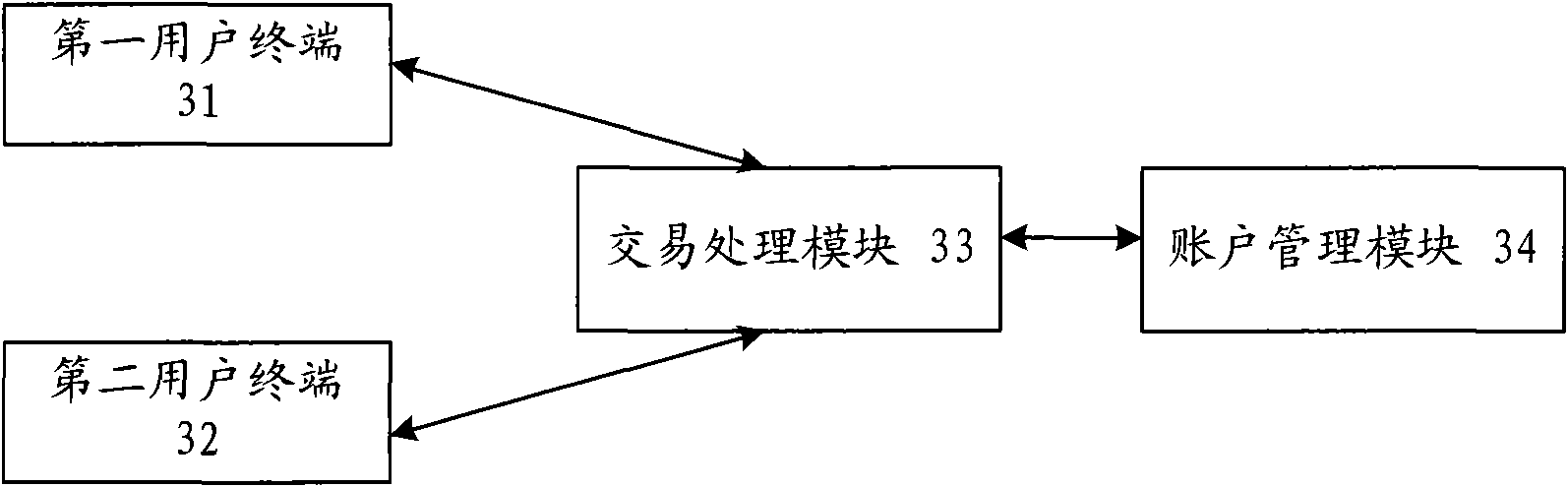

Method and system for processing transaction data and payment system

The invention discloses a method and a system for processing transaction data and a payment system, solving the problem of complicated data processing procedures and low security in the prior transaction method. The method comprises the steps: sending an advance payment request to a third party system by a first user terminal; notifying a bank system to freeze the advance fund data in a first user account by the third party system according to the advance payment request; freezing the advance fund data in the first user account by the bank system according to an instruction of the third party system; sending a confirmation payment request to the third party system by the first user terminal; and notifying the bank system to unfreeze the advance fund data by the third party system according to the confirmation payment request and transferring the advance fund data from the first user account to a second user account. The invention is unnecessary to deposit to the third party organization before the transaction is finished and only freeze the part of the fund data, thereby reducing the processing procedures of the transaction data and ensuring the security of the transaction.

Owner:CHINA UNIONPAY

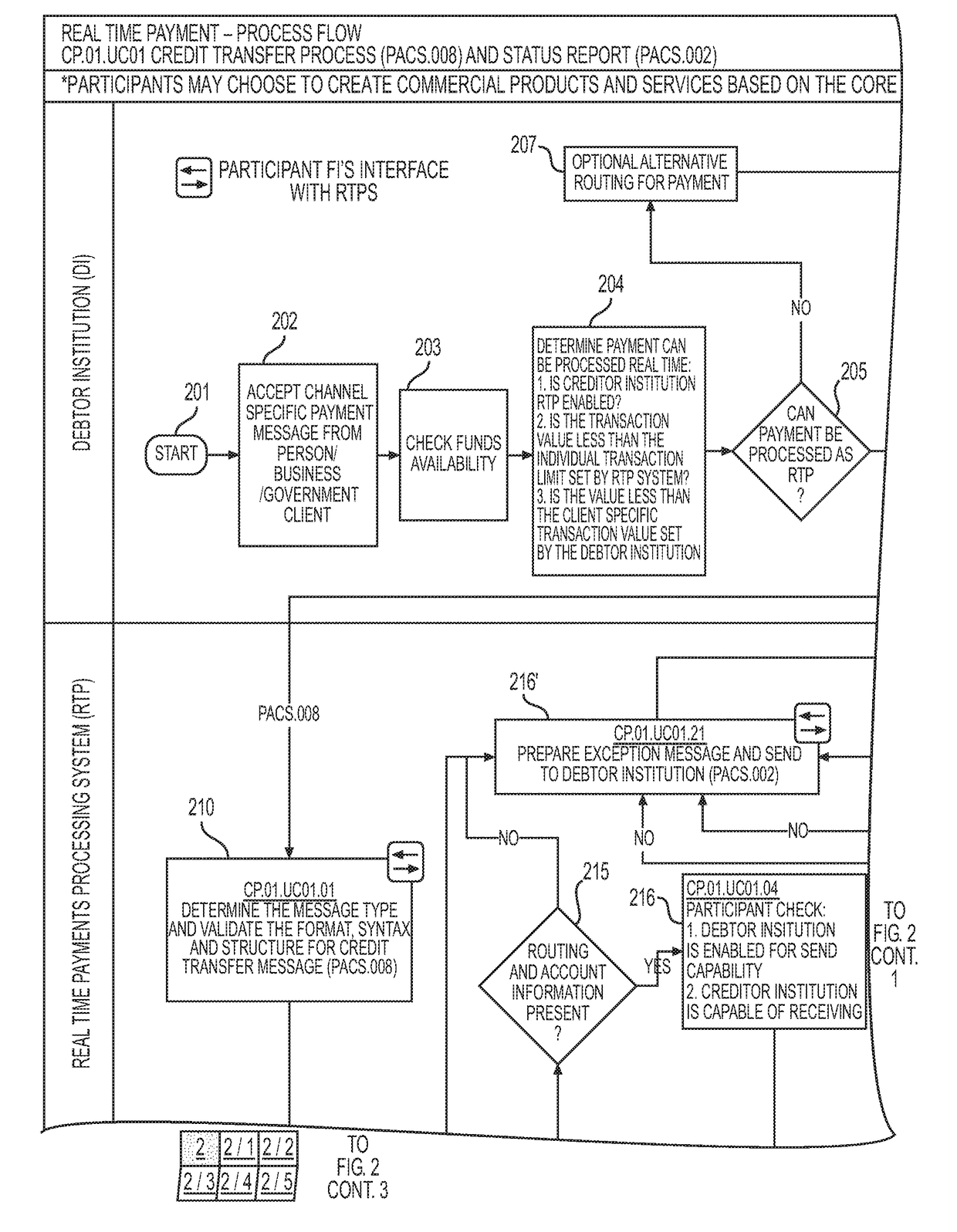

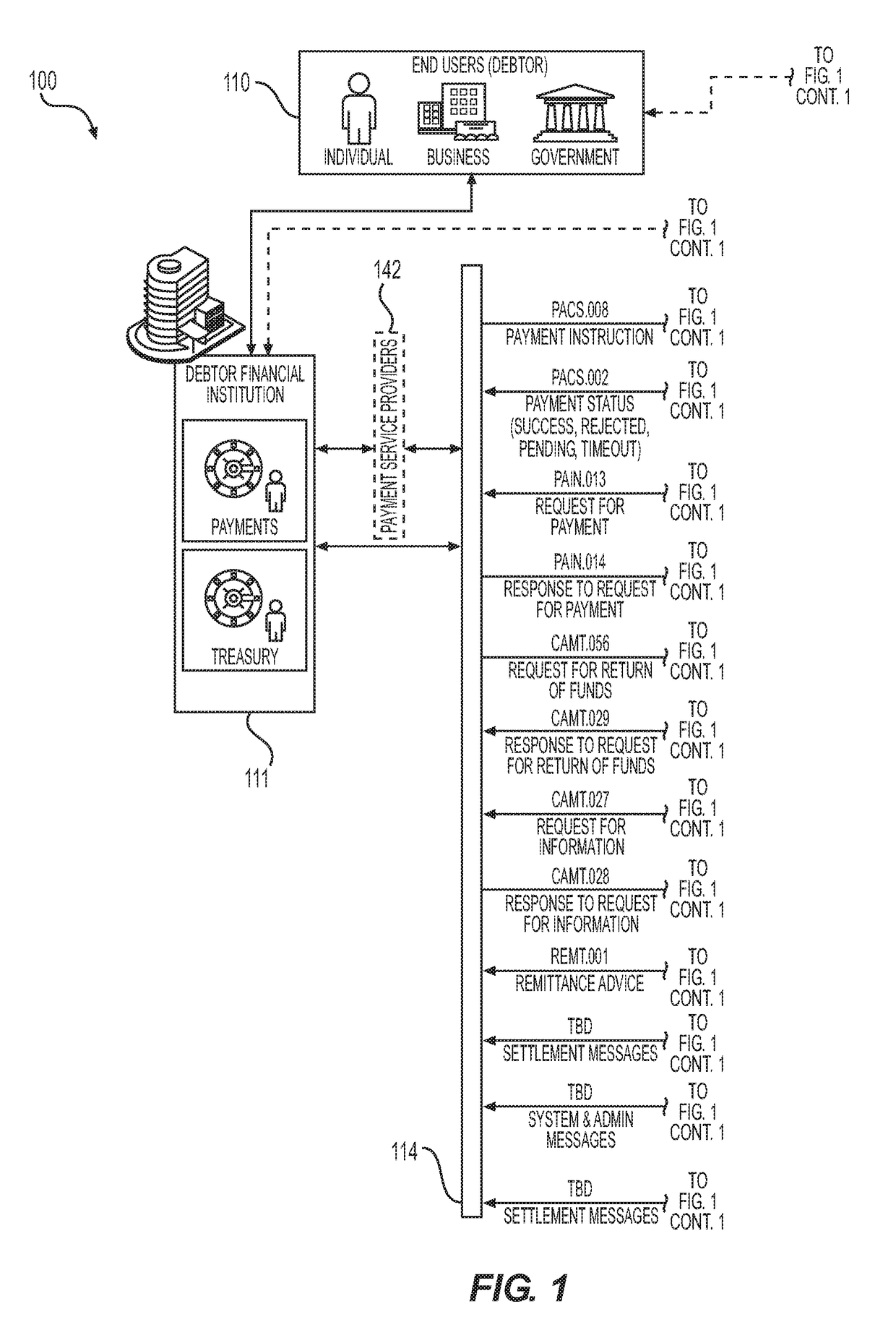

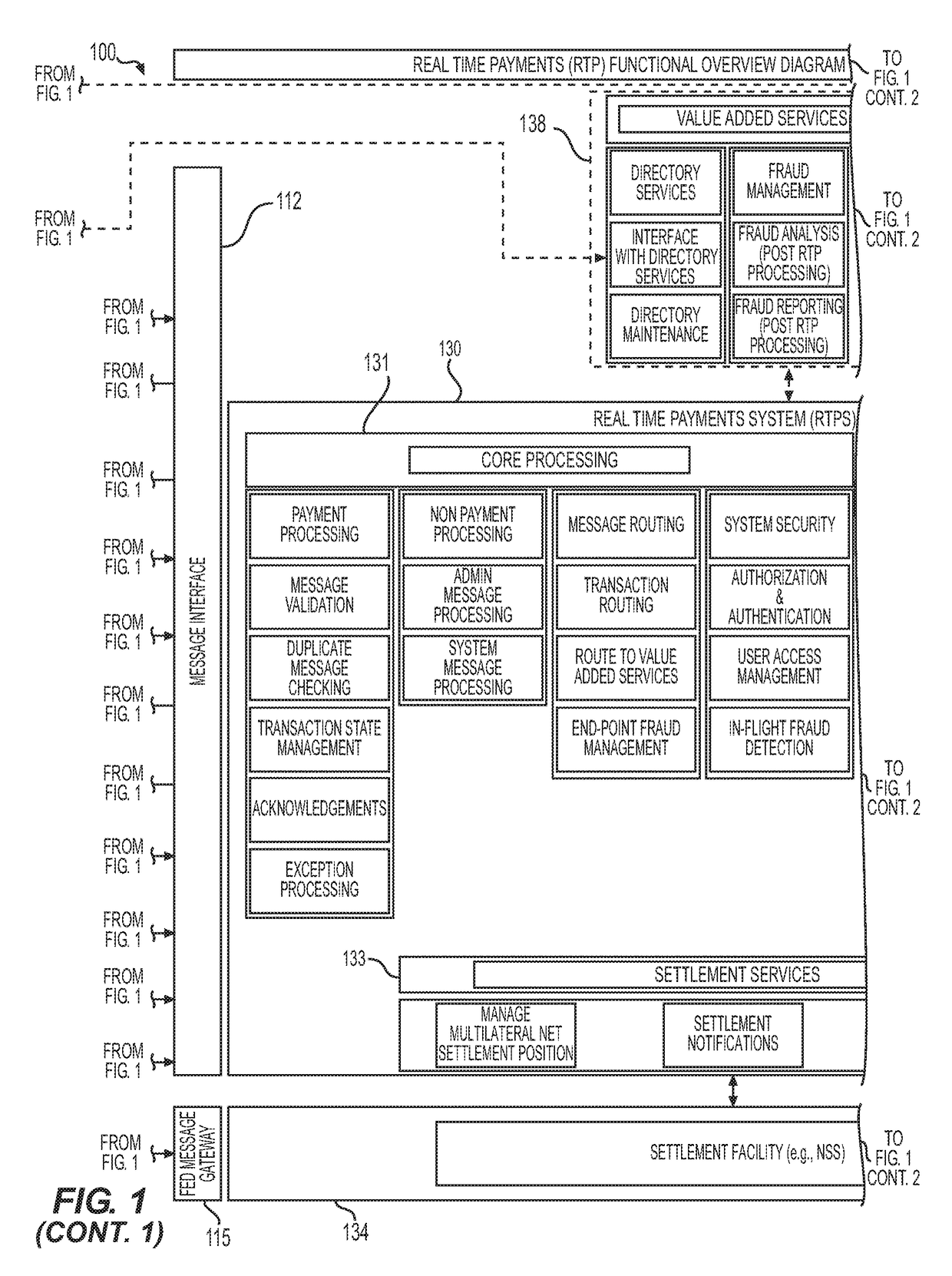

Real-time payment system, method, apparatus, and computer program

A method, system, apparatus, and computer program for conducting a real-time payment settlement transaction. The method includes determining a prefunded requirement for one or more financial institutions. A prefunded balance is stored, based on a prefunded payment received in a separate funding account, for each of the one or more financial institutions. The method further includes receiving an electronic request for payment message from at least one creditor financial institution, and forwarding the electronic request for payment message to at least one debtor financial institution, the electronic request for payment message requesting that a payment be made to the at least one creditor financial institution and comparing the amount of payment requested in an electronic payment transaction to the prefunded balance of the at least one debtor financial institution. A real-time financial settlement transaction is performed based on a result of the comparing step.

Owner:THE CLEARING HOUSE PAYMENTS

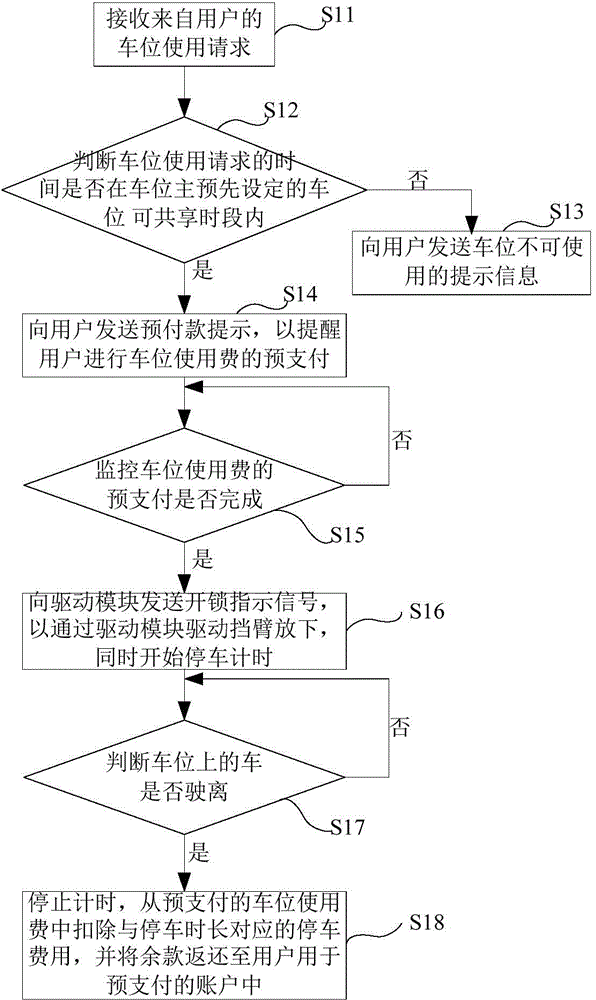

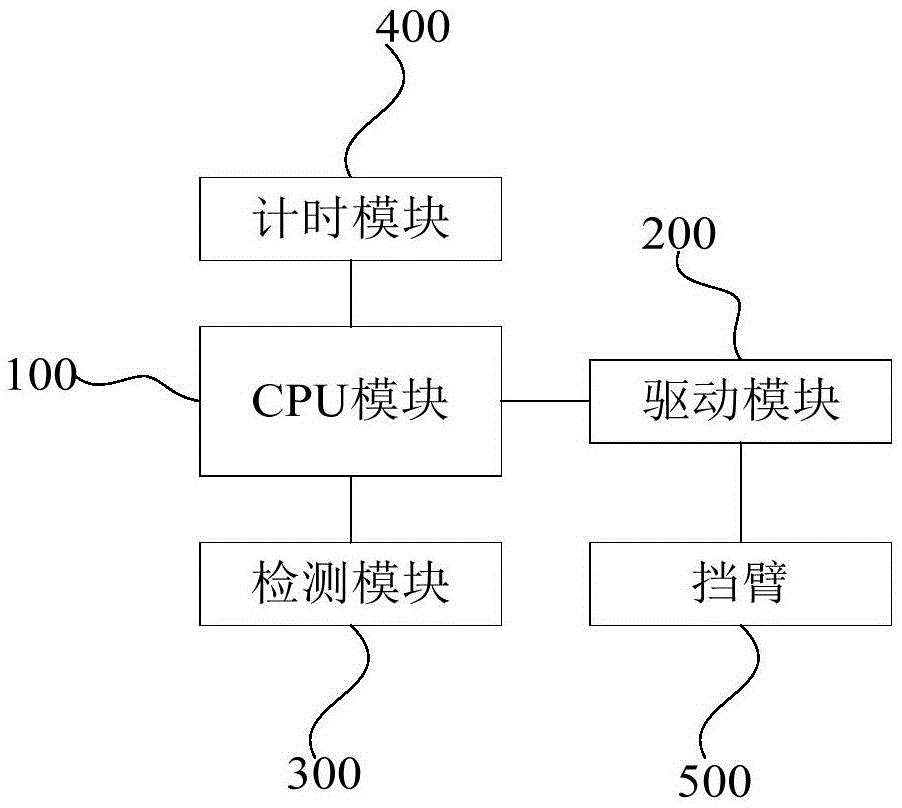

Private parking space sharing method and parking space lock

InactiveCN104574546AReduce restrictionsPrevent casual parkingTicket-issuing apparatusParking metersParking spaceReal-time computing

The invention discloses a private parking space sharing method and a parking space lock. The method includes the steps that firstly, a parking space using request from a user is received; secondly, the user is guided to enter the advance payment procedure of the parking space using charge according to the parking space using request; thirdly, whether advance payment of the parking space using charge is completed or not is monitored, if yes, the fourth step is executed, and if not, monitoring is conducted continuously; fourthly, the parking space lock is controlled to be unlocked for parking, and meanwhile parking timing is started; fifthly, whether a vehicle on a parking space runs away or not is judged, if not, time is kept continuously, and if yes, the sixth step is executed; sixthly, time keeping is stopped, the charge corresponding to the parking duration is deducted from the parking space using charge which is paid in advance, and meanwhile the parking space lock is controlled to reset and parking is forbidden.

Owner:林强

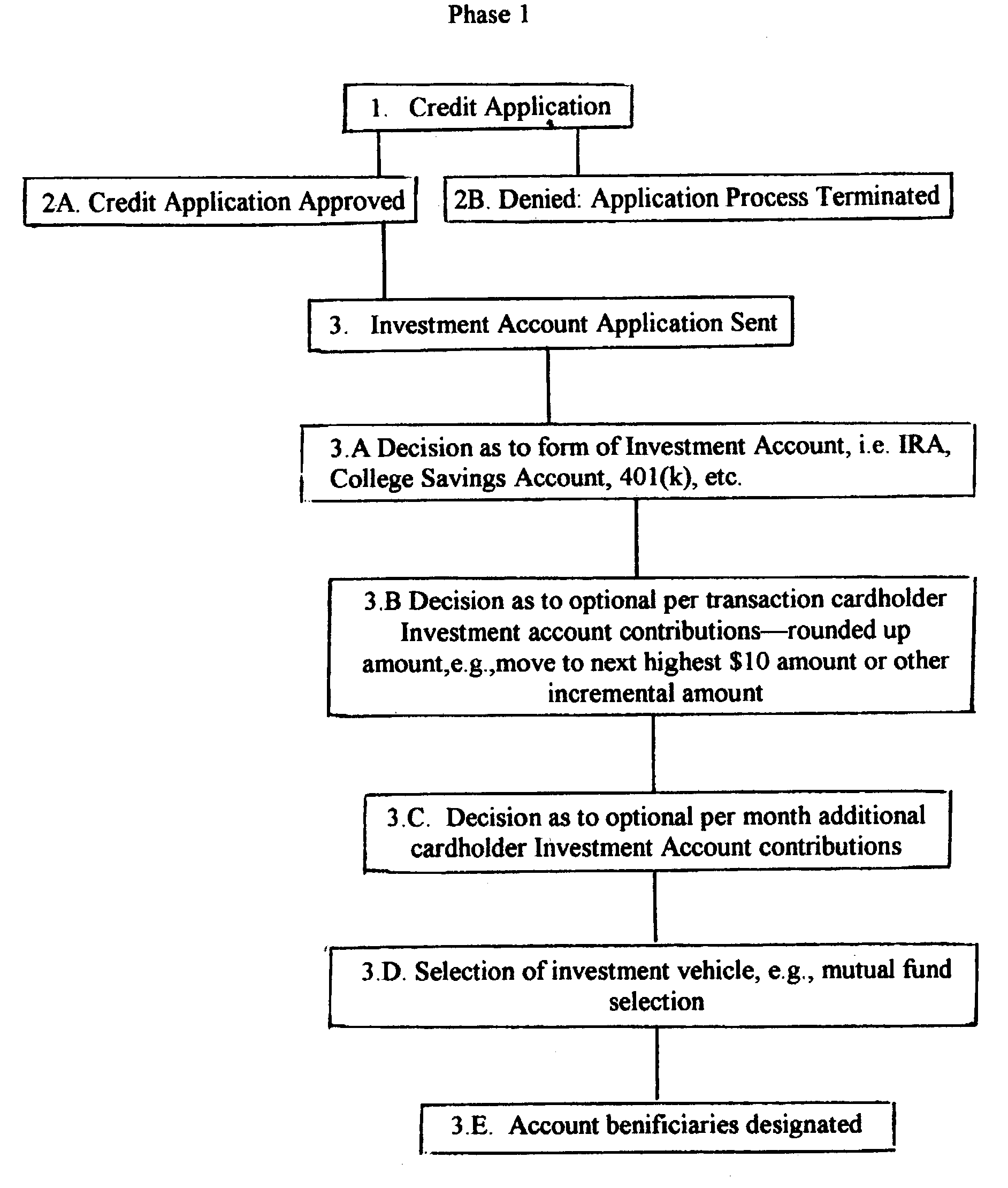

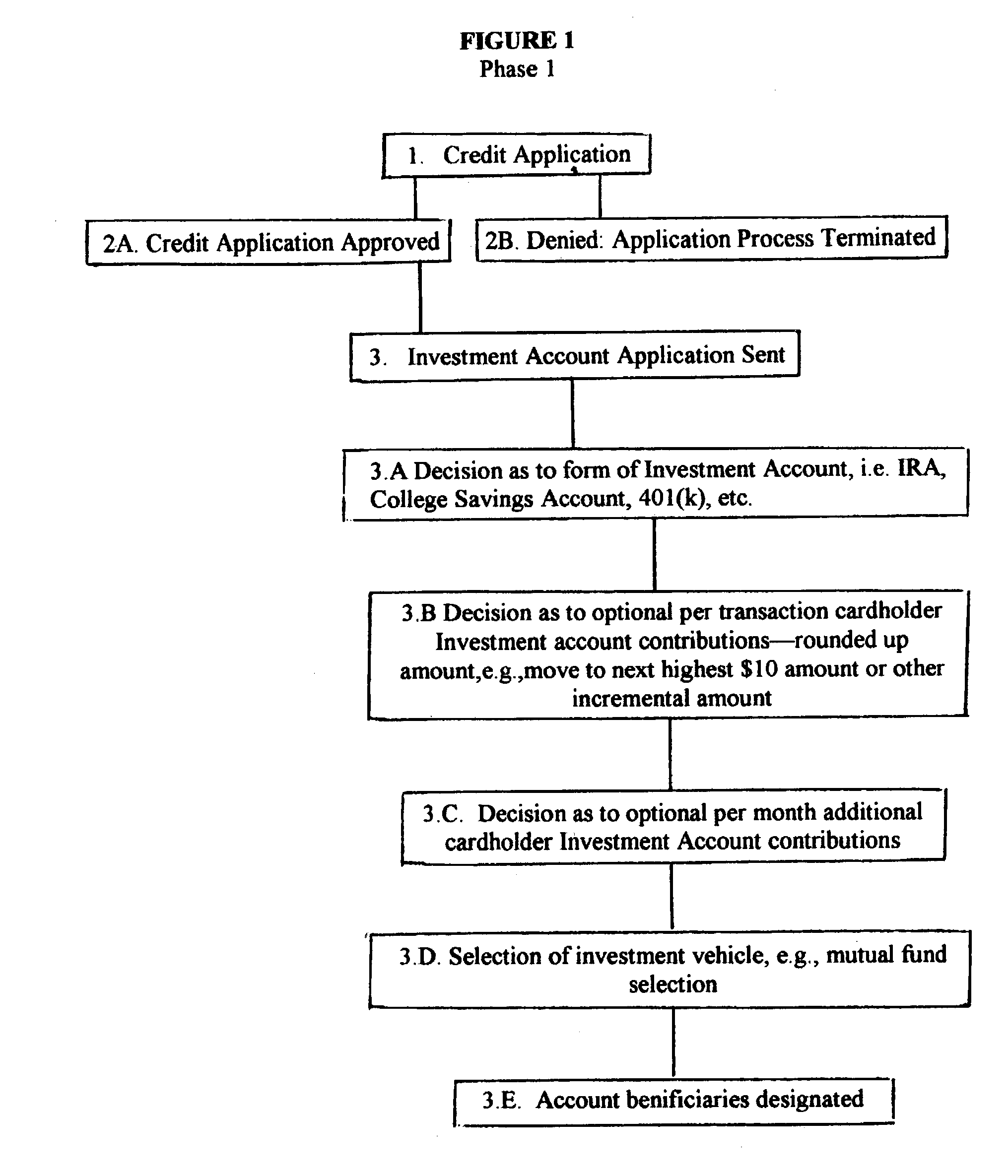

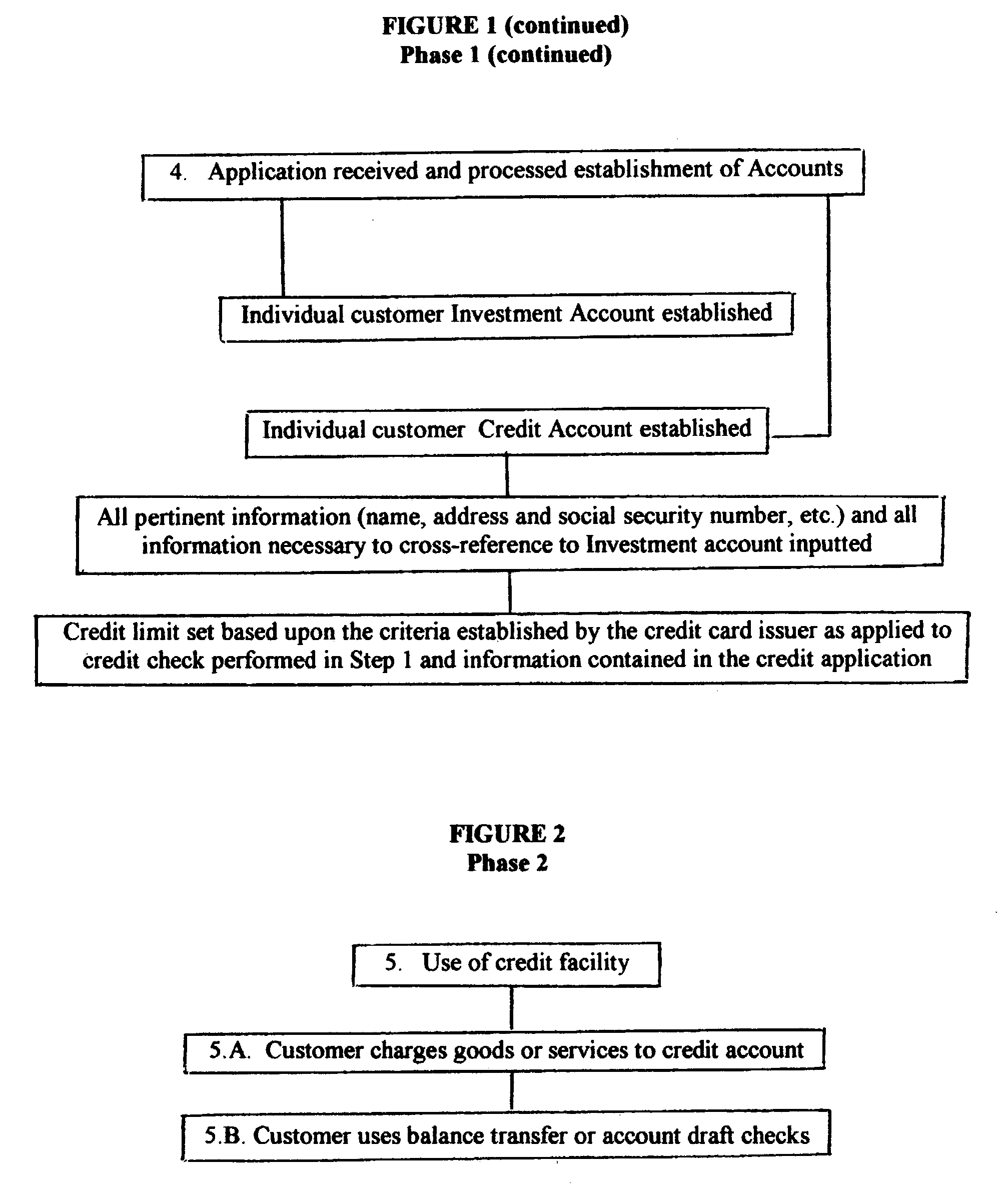

System and method for automatically investing in an investment or savings account by using the "rounded up" of credit card purchase amounts to produce savings/investment amounts

A central computer includes data input means, data processing means and data storage means and is used by a credit card issuer for automatically funding an investment for the credit card holder. A rounded-up numerical figure selected by the cardholder is stored in the memory of the computer. The computer maintains a record of the purchase or advance amount each time the cardholder uses the creditcard. The data processing means determines, with reference to the rounded-up numerical figure, a rounded amount which is in excess of the purchase or advance amount. The data processing means also determines a savings amount (which is periodically transferred to the investment account) by subtracting the purchase or advance amount from the rounded amount.

Owner:SIMPSON MARK S

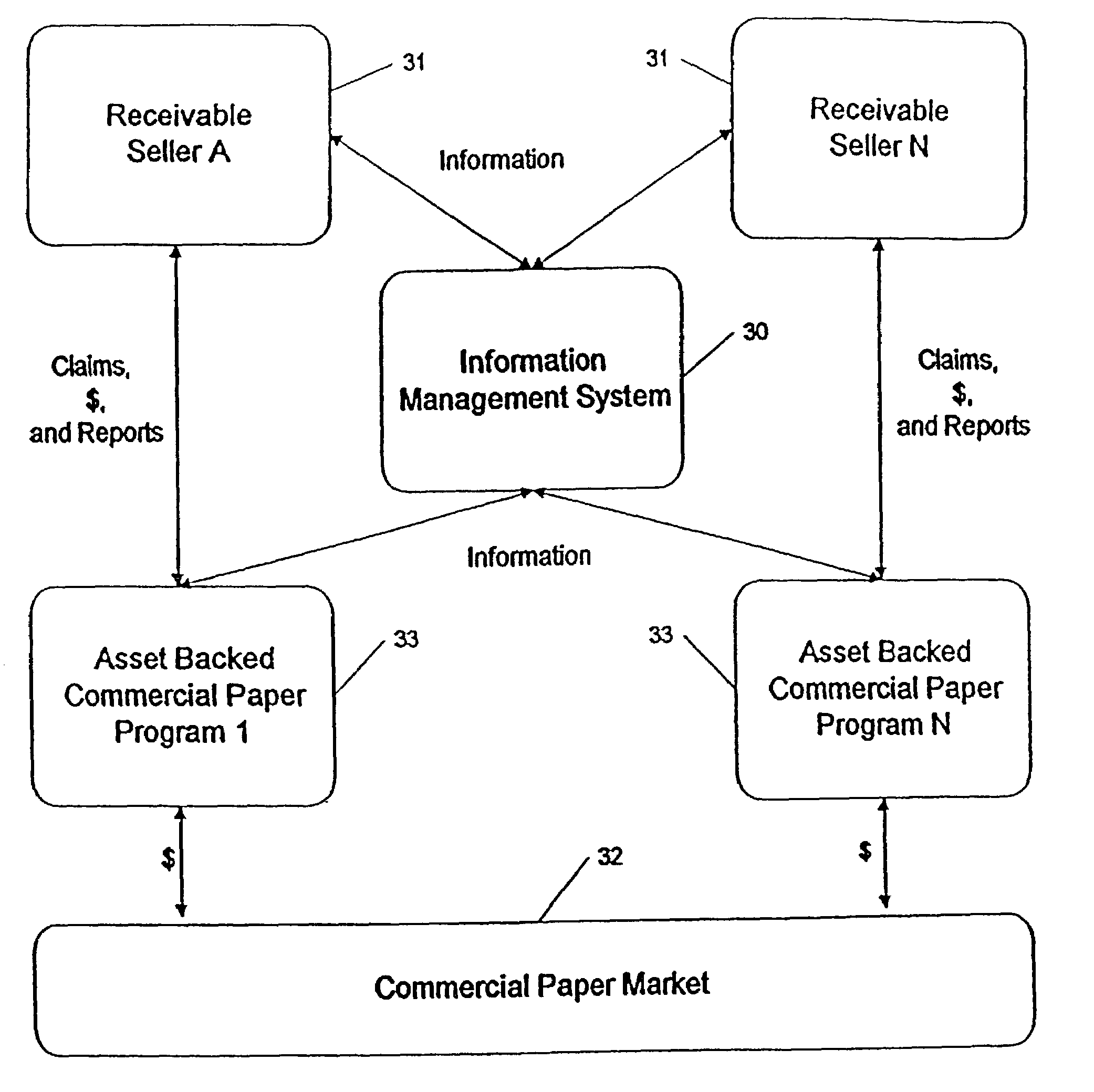

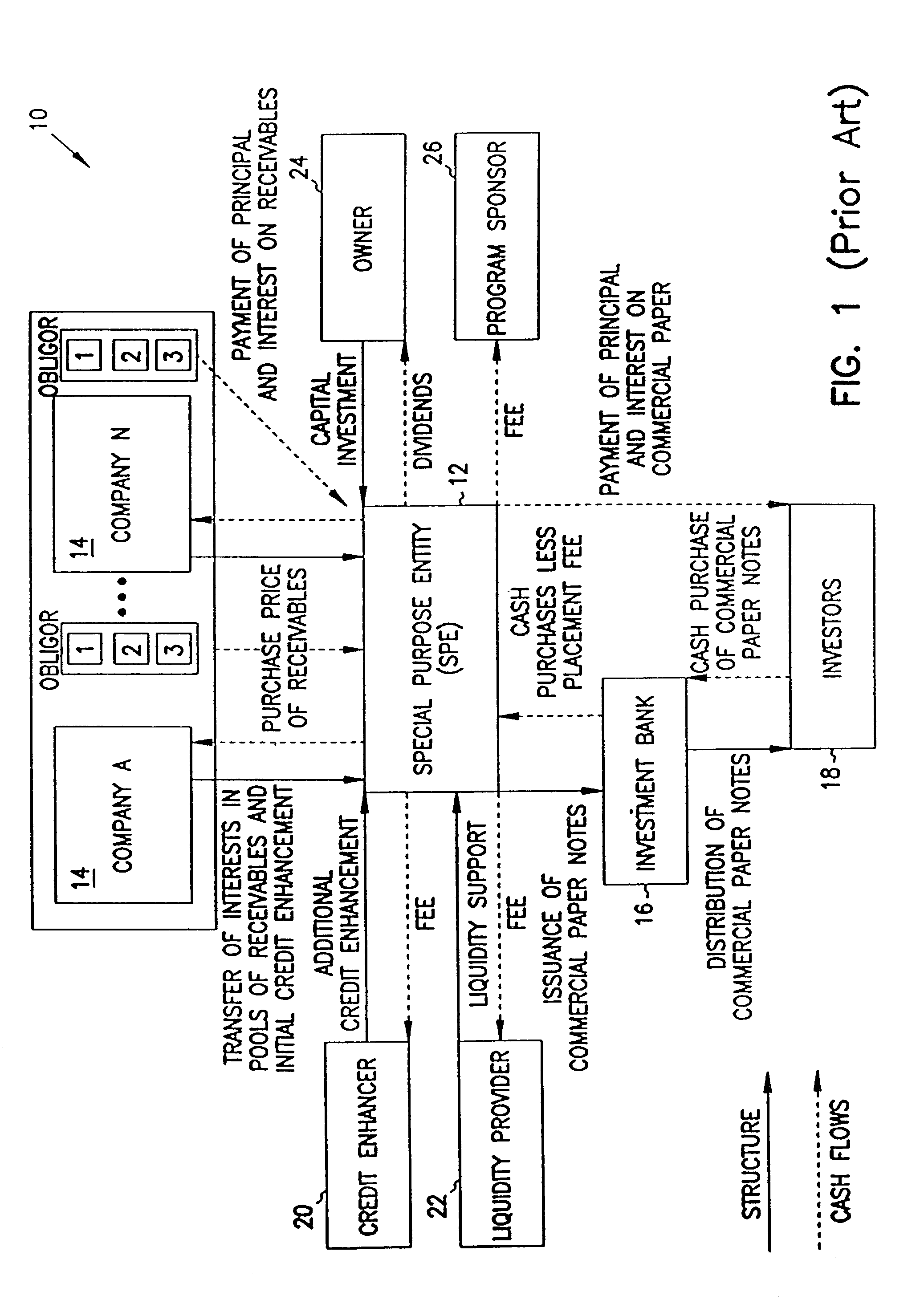

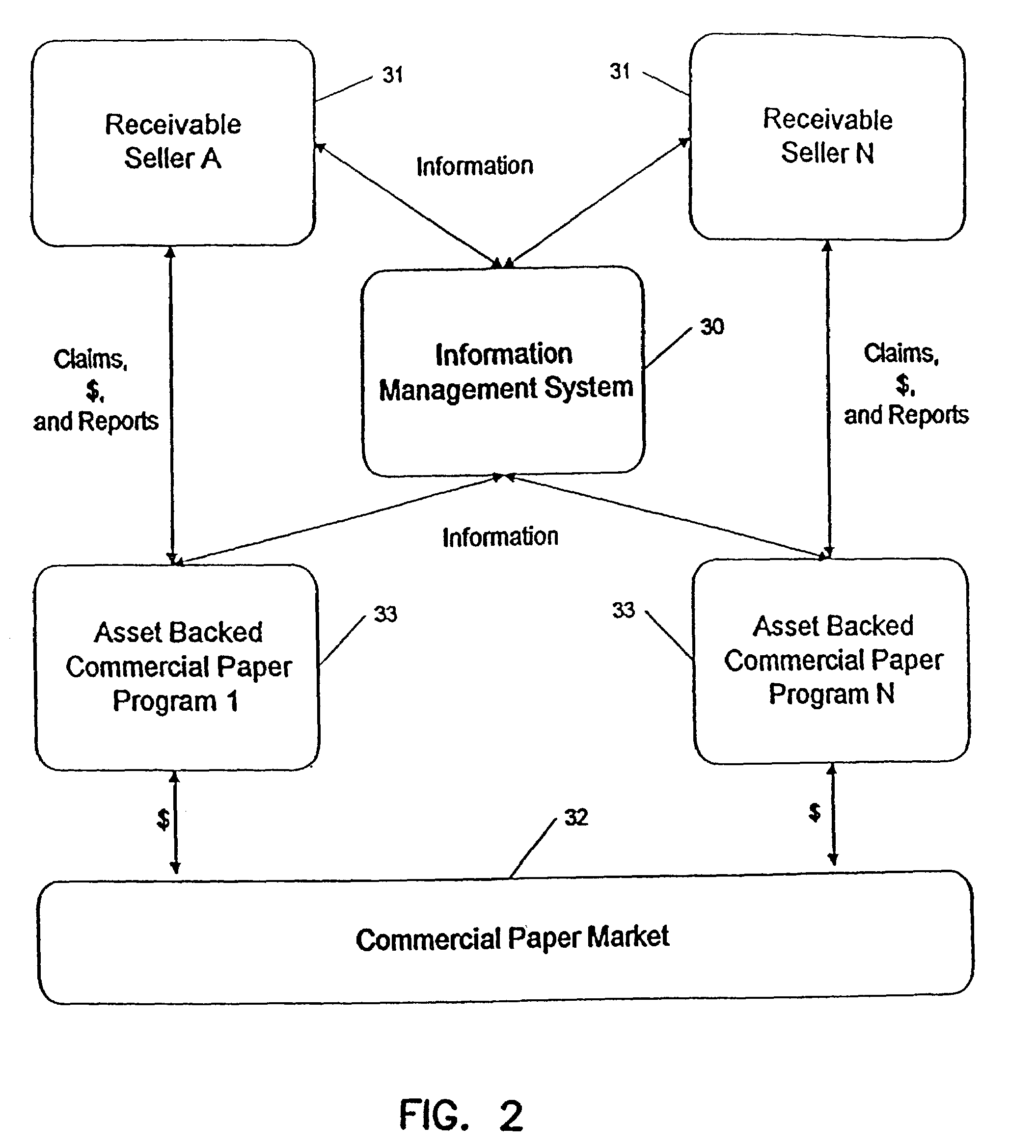

System for invoice record management and asset-backed commercial paper program management

A computerized system that will allow healthcare providers to access the commercial paper market by “selling” their patient claims to asset backed commercial paper conduits. The system generates the statistical information on the historic collection experience of the provider's claims required by both the rating agencies and the sponsors of the conduits. This statistical information has two pieces: the net collectible value matrix showing the percentage of the claim actually paid by individual payers; and a collection histogram showing the timing of the payers payments from the date of initial billing. The system also generates the accounting detail necessary for controlling and auditing the provider's participation in the commercial paper conduit program. The system tracks “periodic pools” of claims so as to be able to reconcile advances, collections, interest expense, third party fees and cash settlements between conduits and providers. This statistical information has two pieces: the net collectible value matrix showing both the percentage of the claim actually paid by individual payors and the standard deviation of this percentage; and a collection histogram showing the timing of the payors' payments from the date of initial billing.

Owner:FIELD RICHARD G

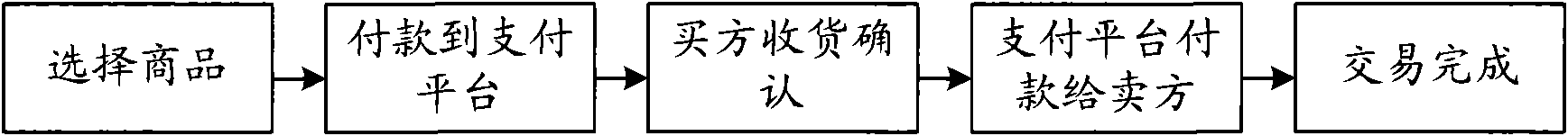

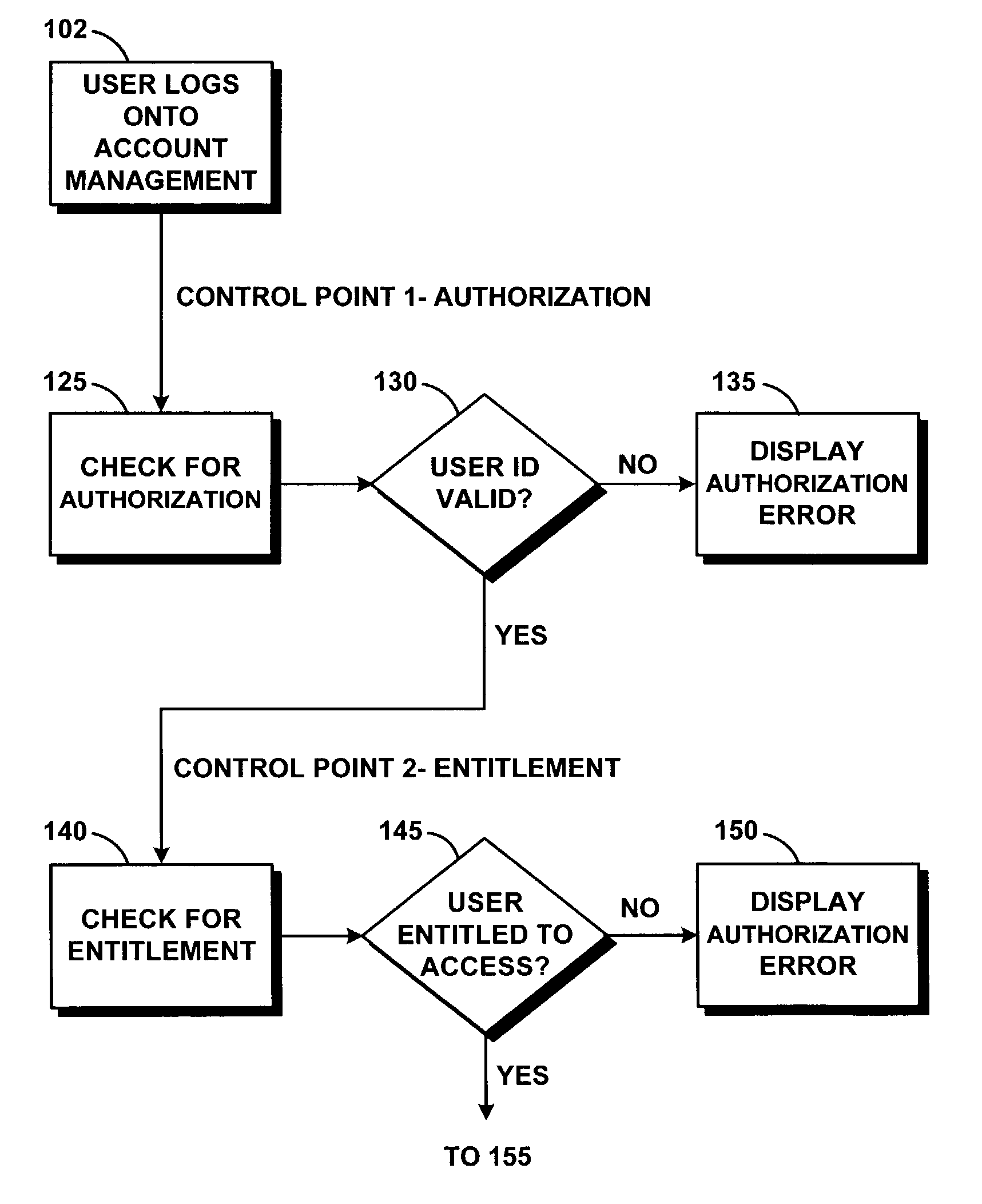

On-line payment method

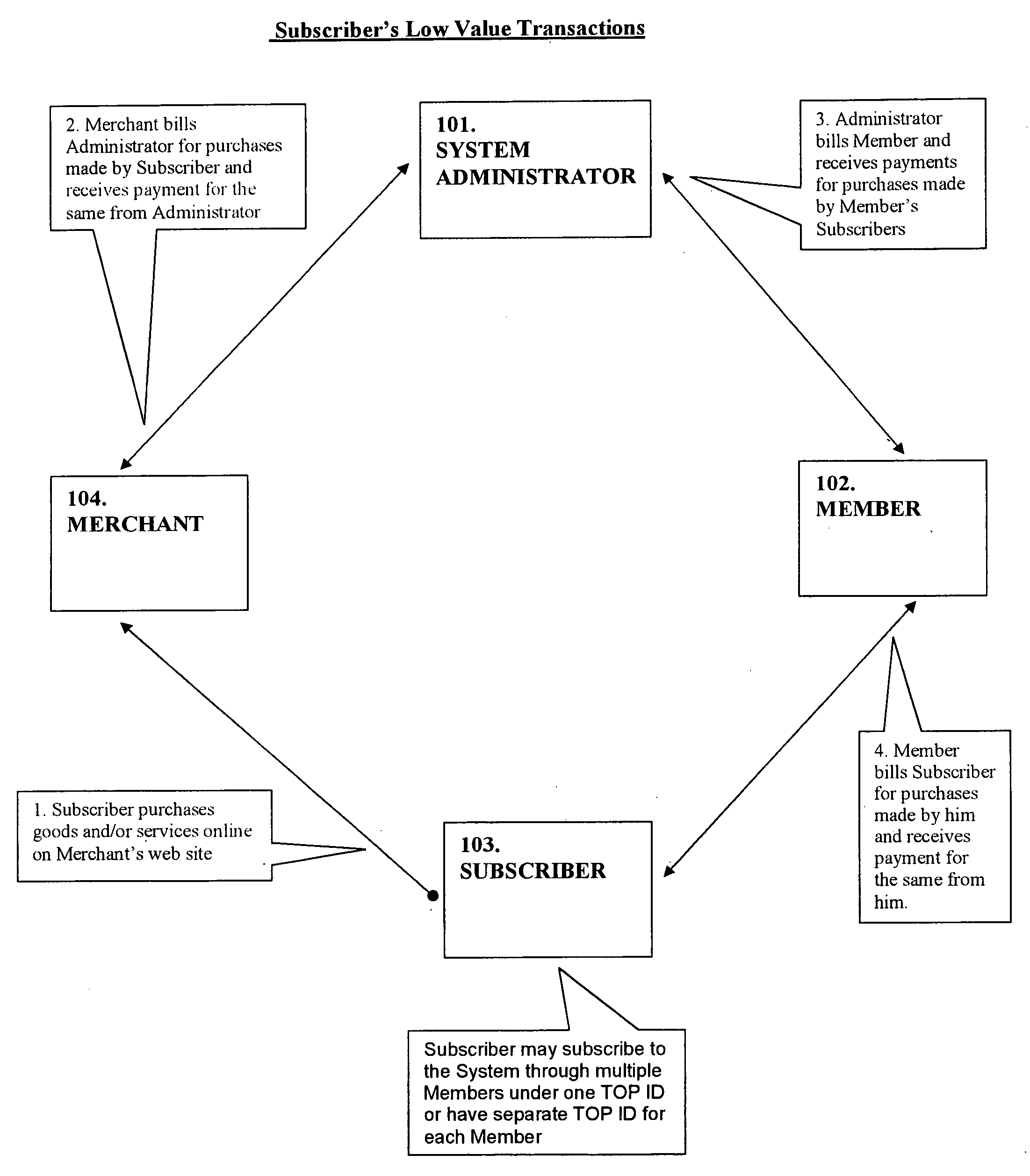

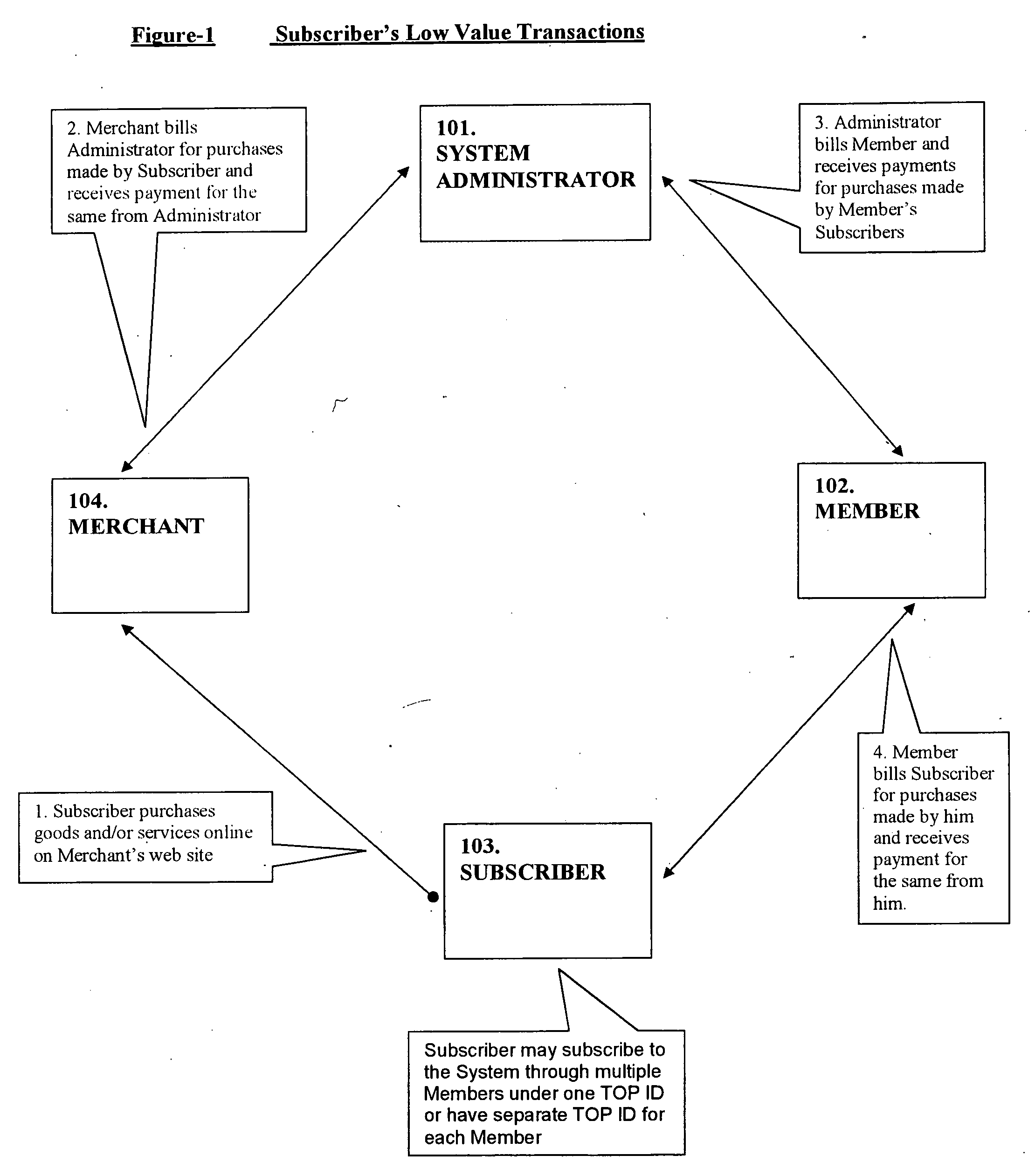

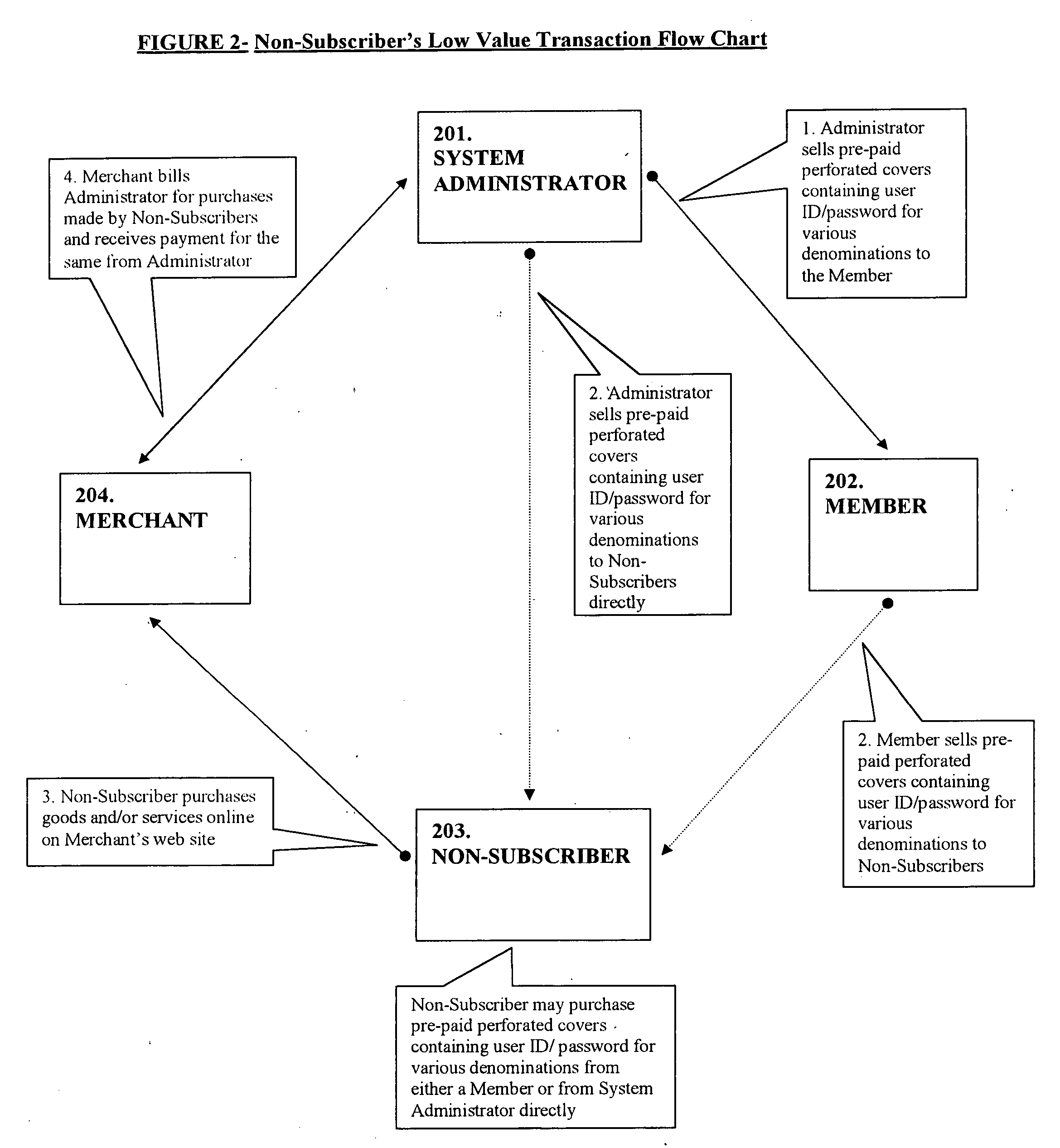

A payment System for online purchases that includes as participants a System Administrator, Members, Merchants and Subscribers / Non-Subscribers. Participating purchasers are Subscribers to a Member. Subscribers have pre-determined purchase limit and pre-determined delivery address for goods purchased within the System. Members may or may not be banking / financial institutions. Merchants charge the System Administrator for the value of all purchases made by subscribing purchasers. The System Administrator charges the Members to which purchasers subscribe for their purchases. System Administrator guarantees payment to Merchants. Members guarantee payment to the System Administrator. Members have their own commercial arrangement in place with their subscribing purchasers to recover money or moneys worth in exchange for the payments they make on behalf of Subscribers to the System Administrator. The System Administrator can be a Member too. The System Administrator may or may not be a financial institution. Non-Subscribers can also do online purchases by making up front payment to the System Administrator / Members to do online shopping on Merchant's site. For large value transactions where multiple signatories are involved the System adopts a unique authentication process to validate the USER ID and password of different signatories. No single server of System administrator shall hold all the signatories' login details. The System is applicable to b2c and / or b2b online payments. The System is applicable to online and / or offline transactions.

Owner:DHARAM PAL

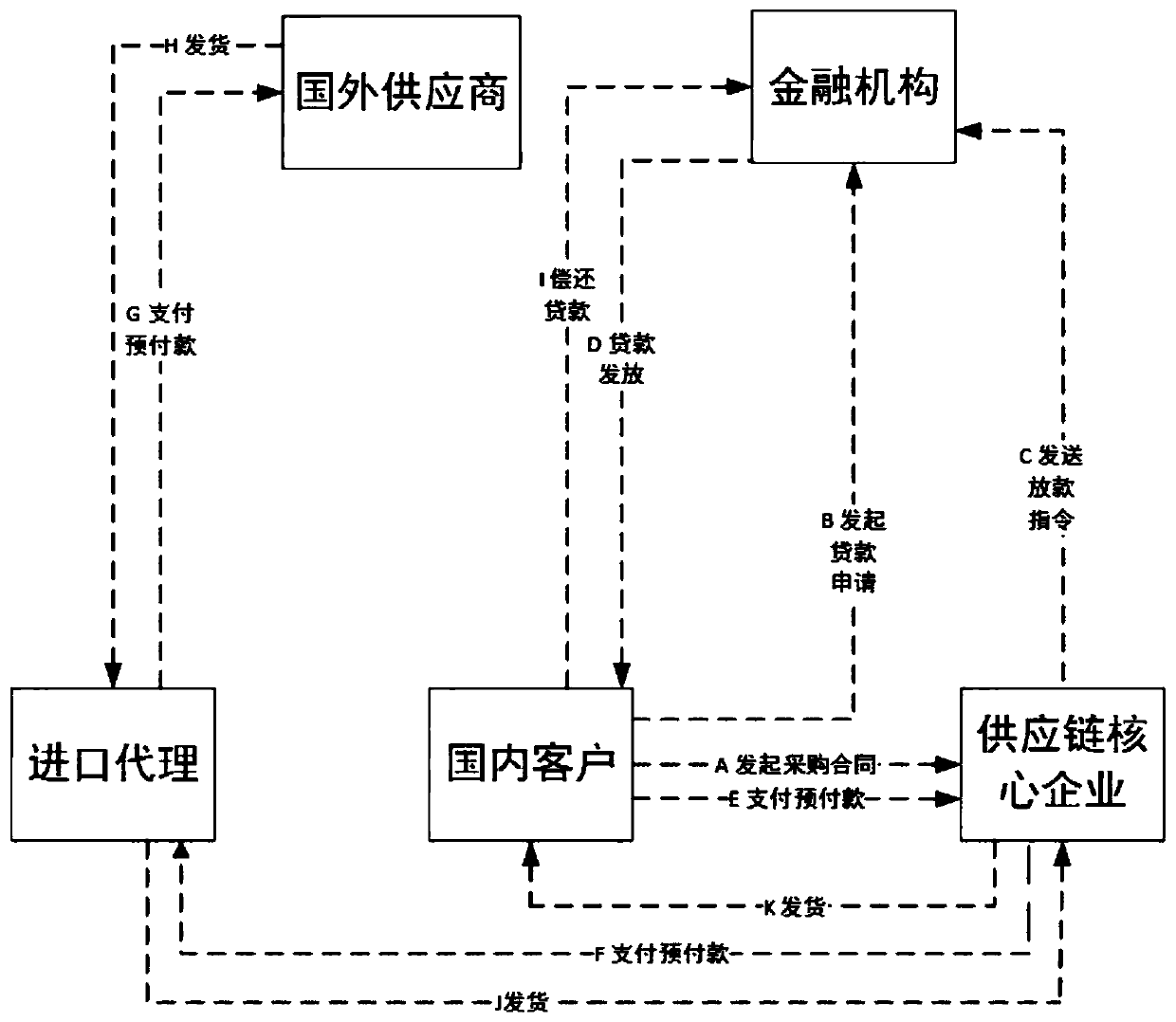

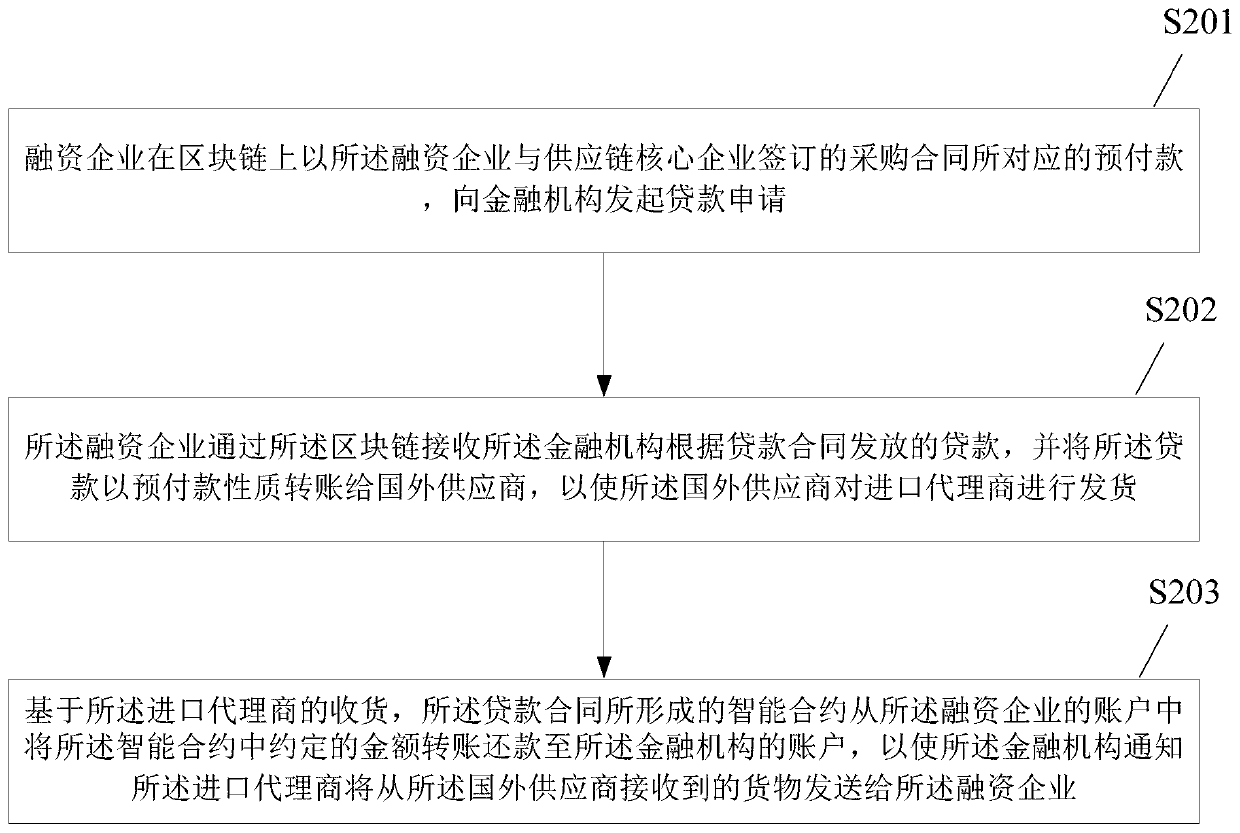

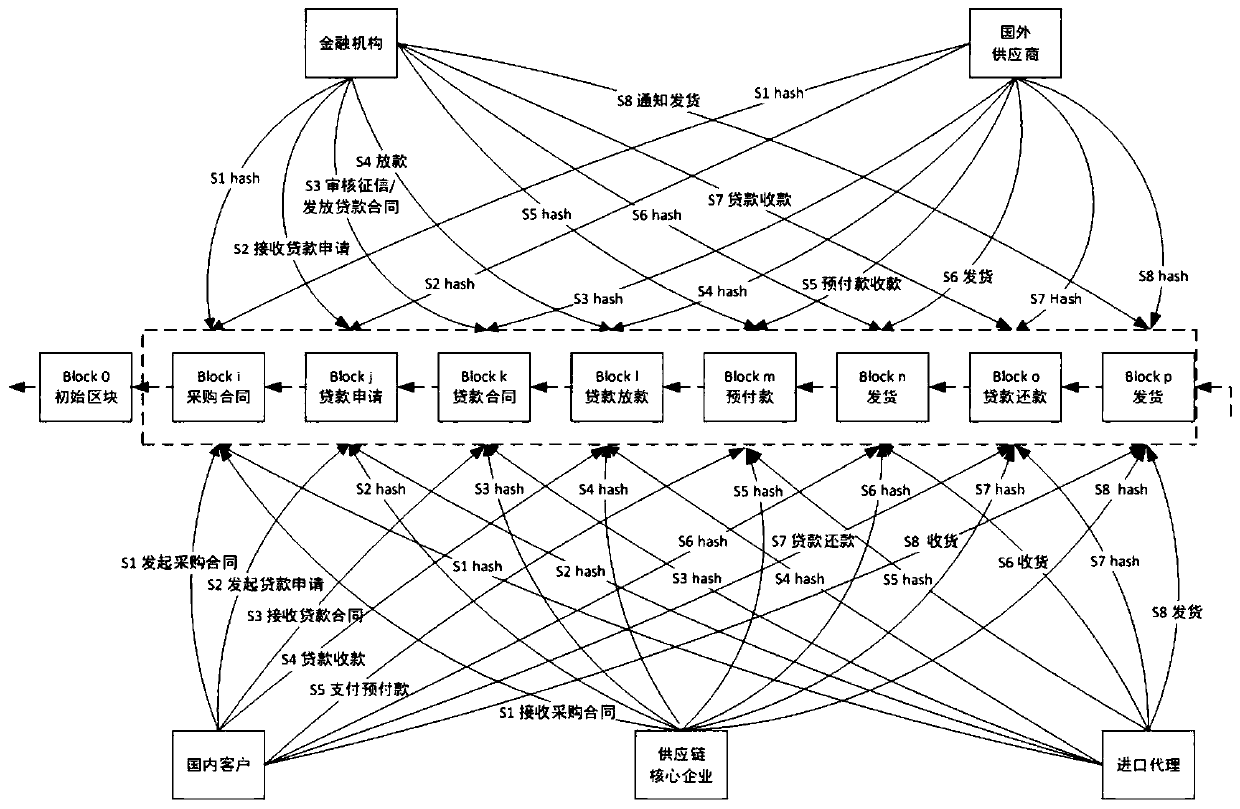

Advance payment financing method and device

ActiveCN110147993AImprove efficiencyImprove reliabilityFinancePayment protocolsSmart contractPurchasing

The embodiment of the invention provides an advance payment financing method and device, and the method comprises the steps: a financing enterprise initiates a loan application to a financial institution through advance payment corresponding to a purchasing contract signed by the financing enterprise and a supply chain core enterprise on a block chain; the financing enterprise receives the loan issued by the financial institution according to the loan contract through the block link, and transfers the loan to foreign suppliers according to the advance payment property, so that the foreign suppliers deliver goods to import agents; based on goods received by the import agent, the intelligent agreement formed by the loan contract transfers money agreed in the intelligent contract from the account of the financing enterprise and repays the money to the account of the financial institution, so that the financial institution notifies the import agent to send the goods received from the foreign supplier to the financing enterprise. According to the embodiment of the invention, the efficiency and reliability of advance payment financing can be improved.

Owner:HUNAN UNIV

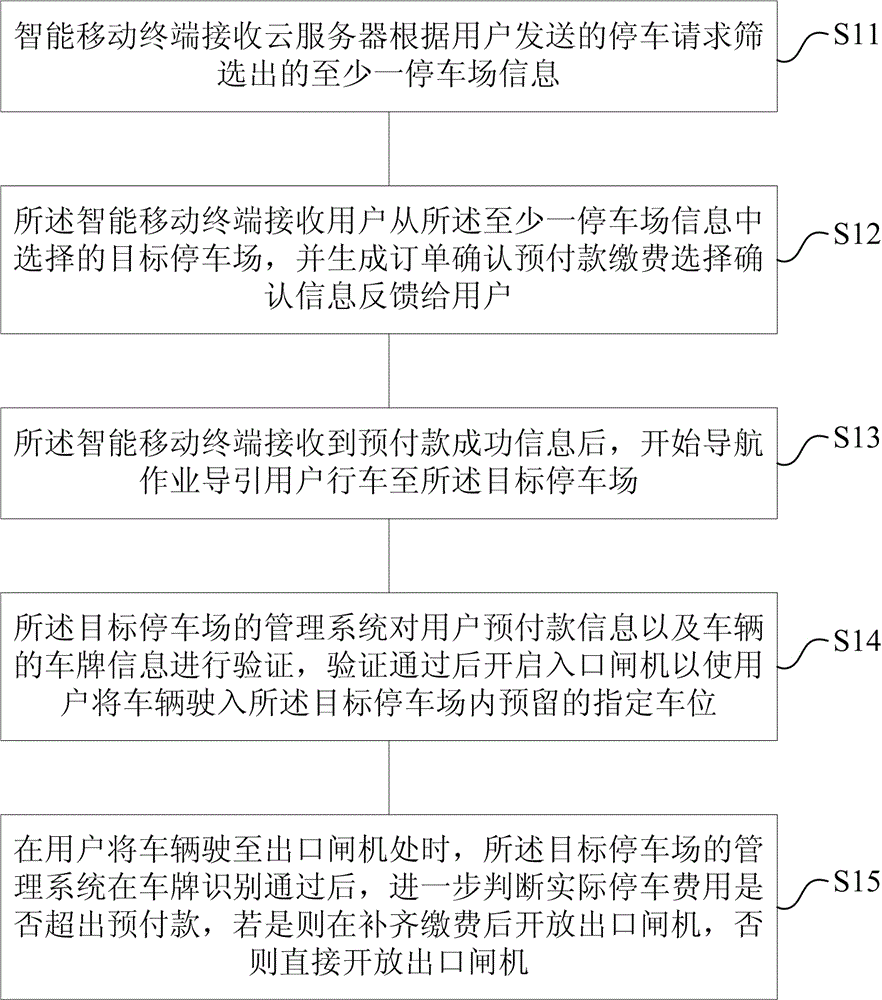

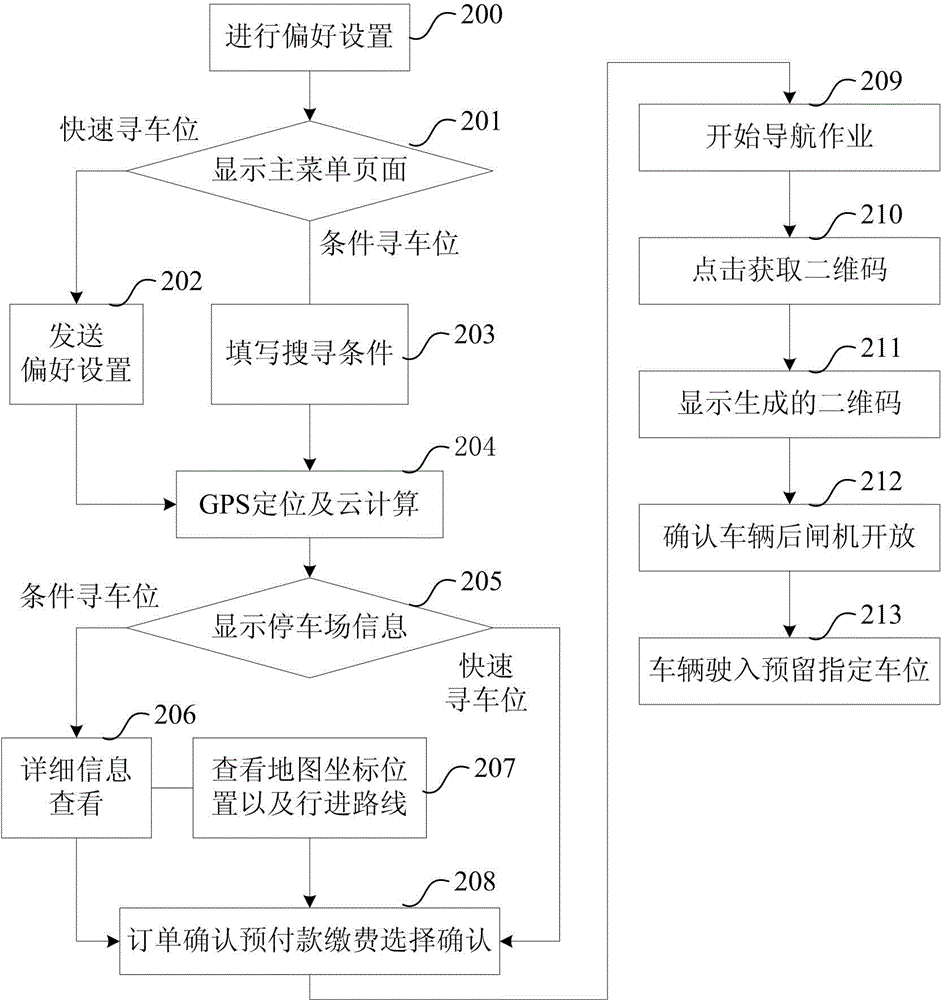

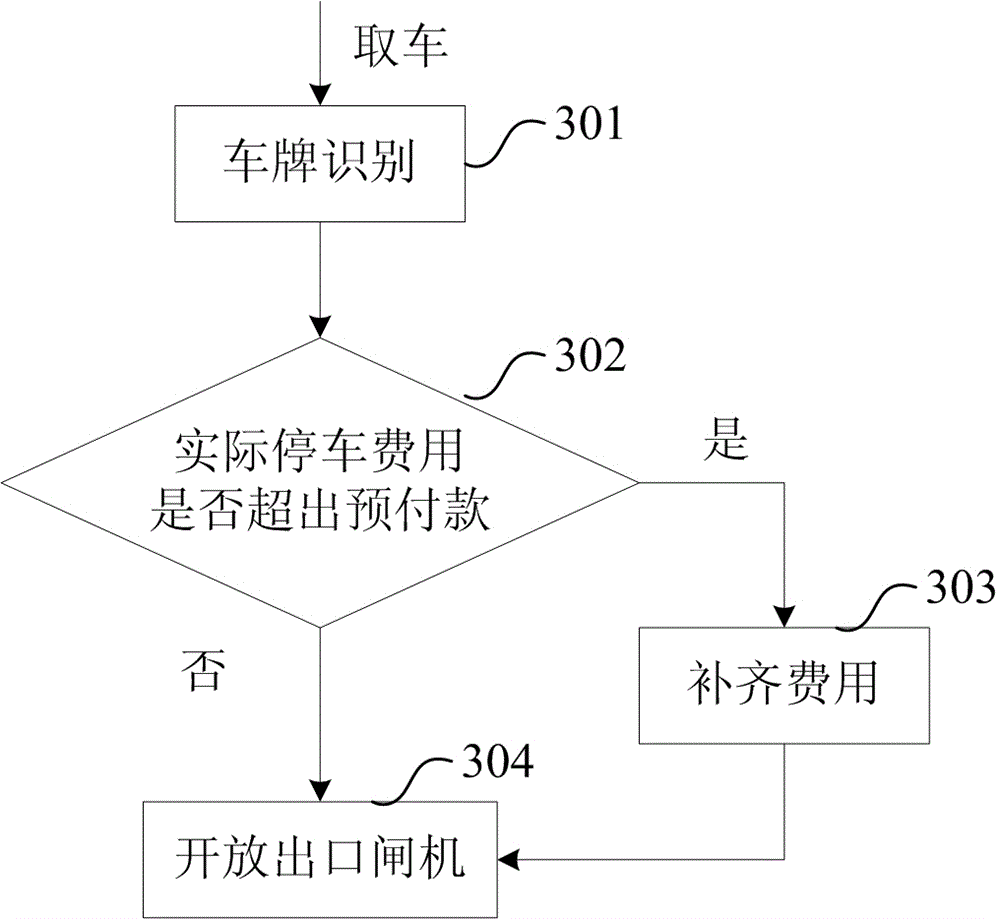

Parking method based on intelligent mobile terminal and parking system thereof

InactiveCN106571058ARealize paymentIncrease usageTicket-issuing apparatusIndication of parksing free spacesParking spaceComputer terminal

The invention provides a parking method based on an intelligent mobile terminal and a parking system thereof. The method comprises the steps that 1) the intelligent mobile terminal receives at least one parking lot information selected by a cloud server through screening according to a parking request transmitted by a user; 2) the intelligent mobile terminal receives a target parking lot selected from at least one parking lot information by the user and generates order confirmation advance payment selection confirmation information to be fed back to the user; 3) the intelligent mobile terminal receives advance payment success information and then starts navigation operation to guide the user to drive to the target parking lot; and 4) the management system of the target parking lot verifies the advance payment information of the user and license plate information of the vehicle, and then an entrance gate is opened after verification is passed so that the user is enabled to drive the vehicle to the reserved designated parking place in the target parking lot. Automatic and efficient place searching and parking can be realized for the user so that the utilization rate of the idle parking lot can be greatly enhanced, the congestion degree of congestion road segments can be effectively alleviated and the parking method and the parking system have wide application and popularization value.

Owner:上海久银车库工程有限公司

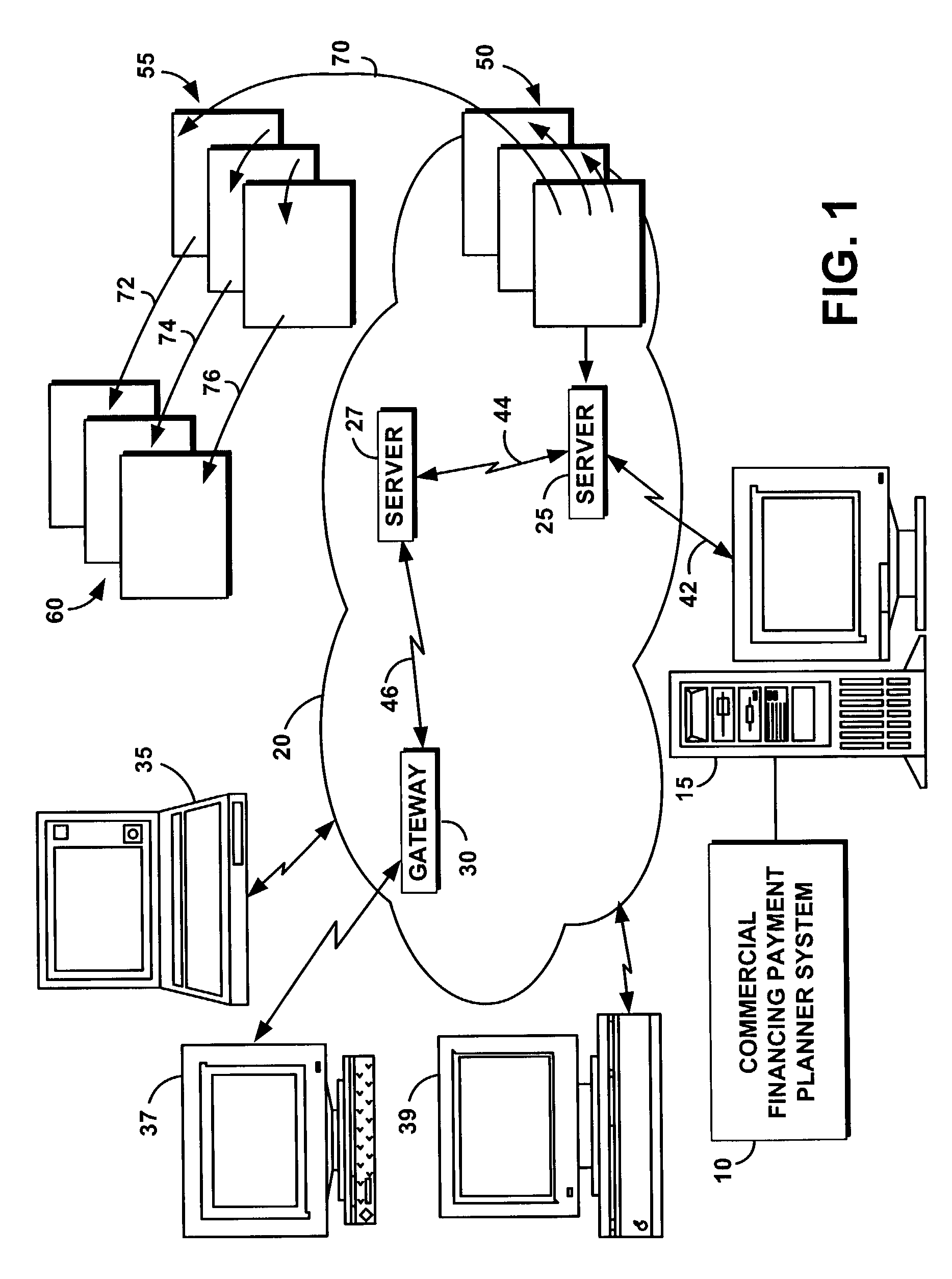

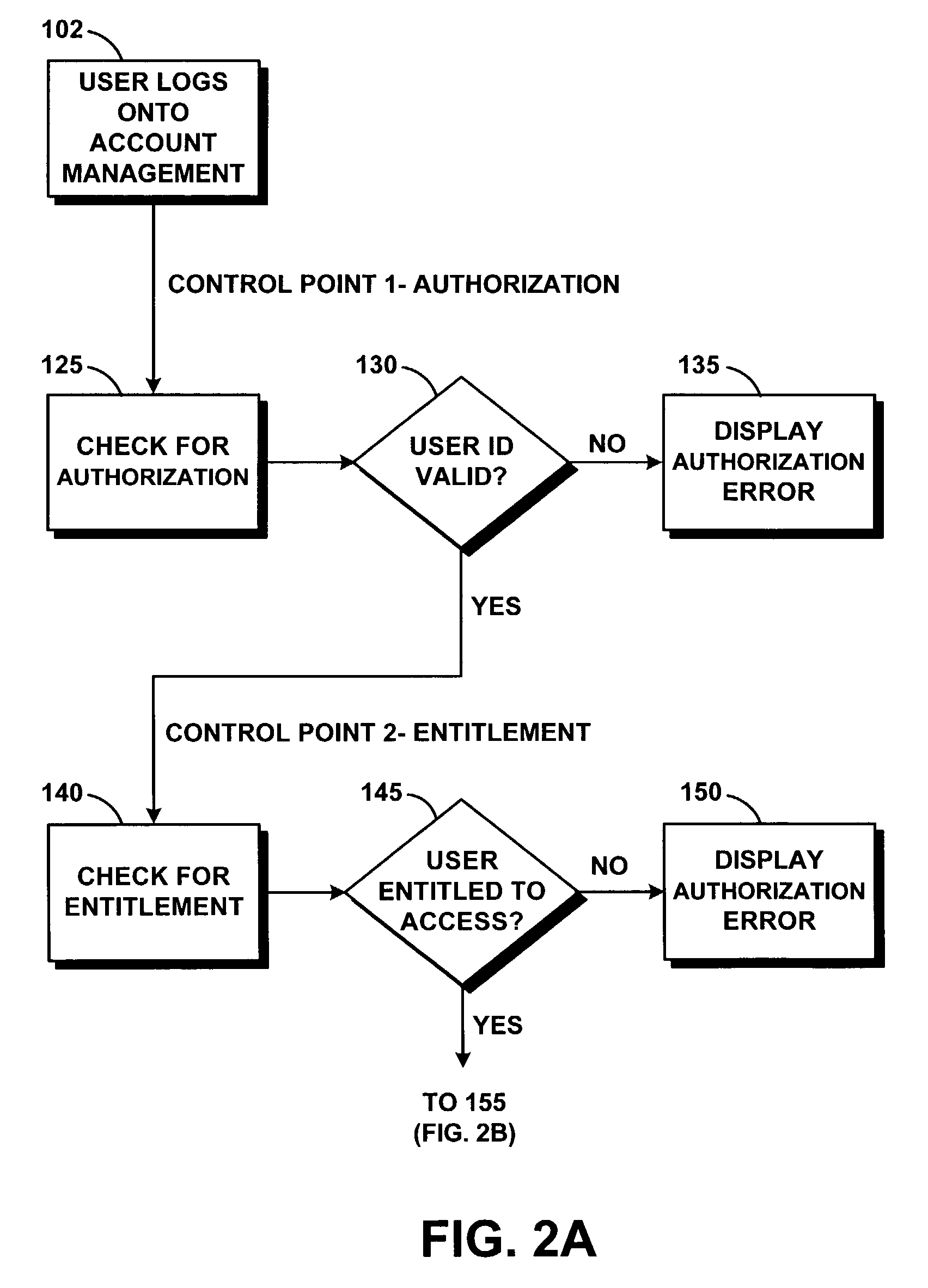

Method for planning commercial financing payment

A commercial financing payment planning system and associated method provide commercial financing customers the ability to retrieve and monitor account activity, track scheduled payment dates, and create / submit remittance instructions online. The system provides numerous functions to a customer, such as customer payment control, access to multiple payment sources by the customer, automatic funds transfer, customized user access, a customer dispute process for disputing supplier invoices, automatic dispute response, and credit tracking. With payment control, the customer specifies which and on what date the invoices will be paid, and the source of funds for the payments. The customer can make these payments from one or a combination of sources. By creating a remittance advice document, the customer can specify in advance payment details and give authorization for automatic payment by the system. The customer can also customize access to control features of the system of the invention for each of the customer's accounts / receivable employees. In the event that the customer has an issue with a supplier's delivery, product, or pricing, the customer can submit a dispute to a supplier. The customer, supplier, and finance company can view a payment dispute and dispute status through the entire dispute process. The system automatically e-mails the customer a response when the dispute is resolved, informing the customer of the result of the resolution. Both the finance company and the customer can track credits applied to the customer's account through the entire dispute process.

Owner:PAYPAL INC

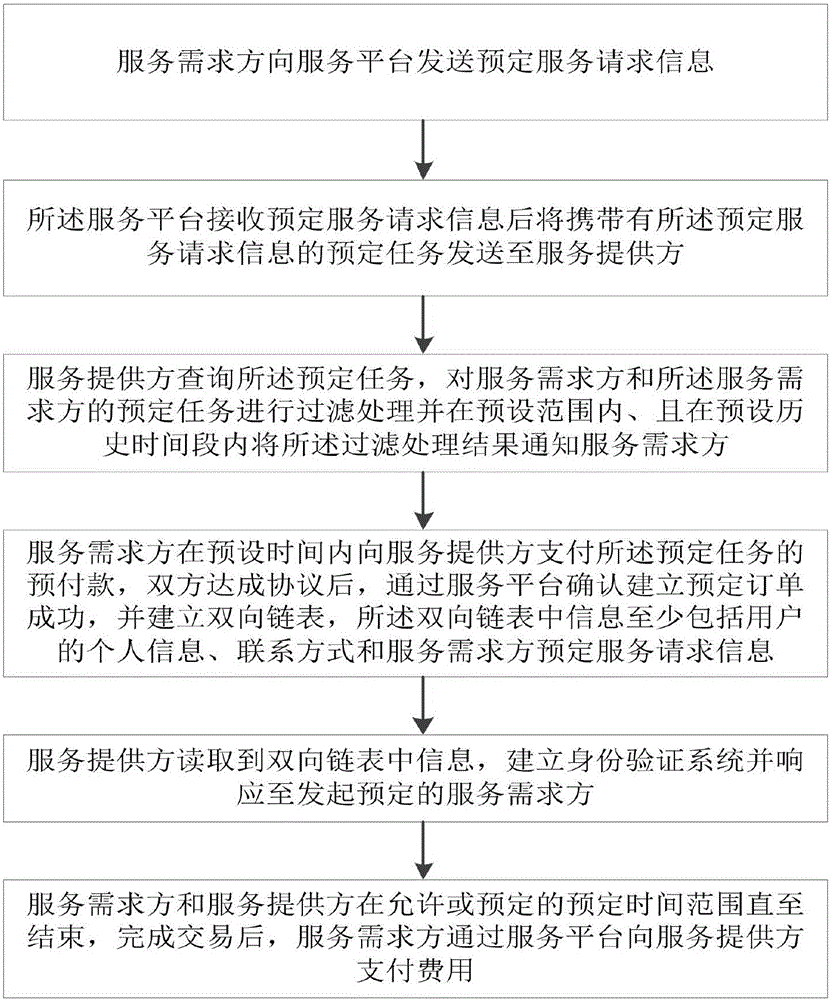

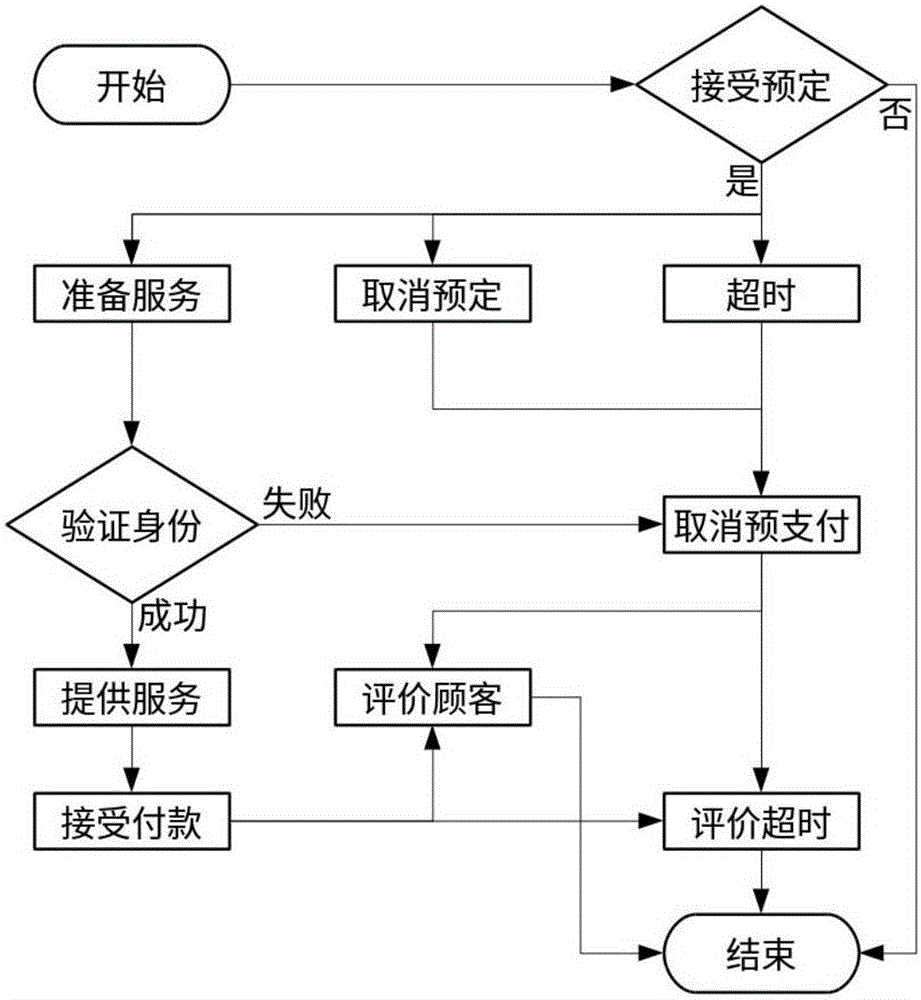

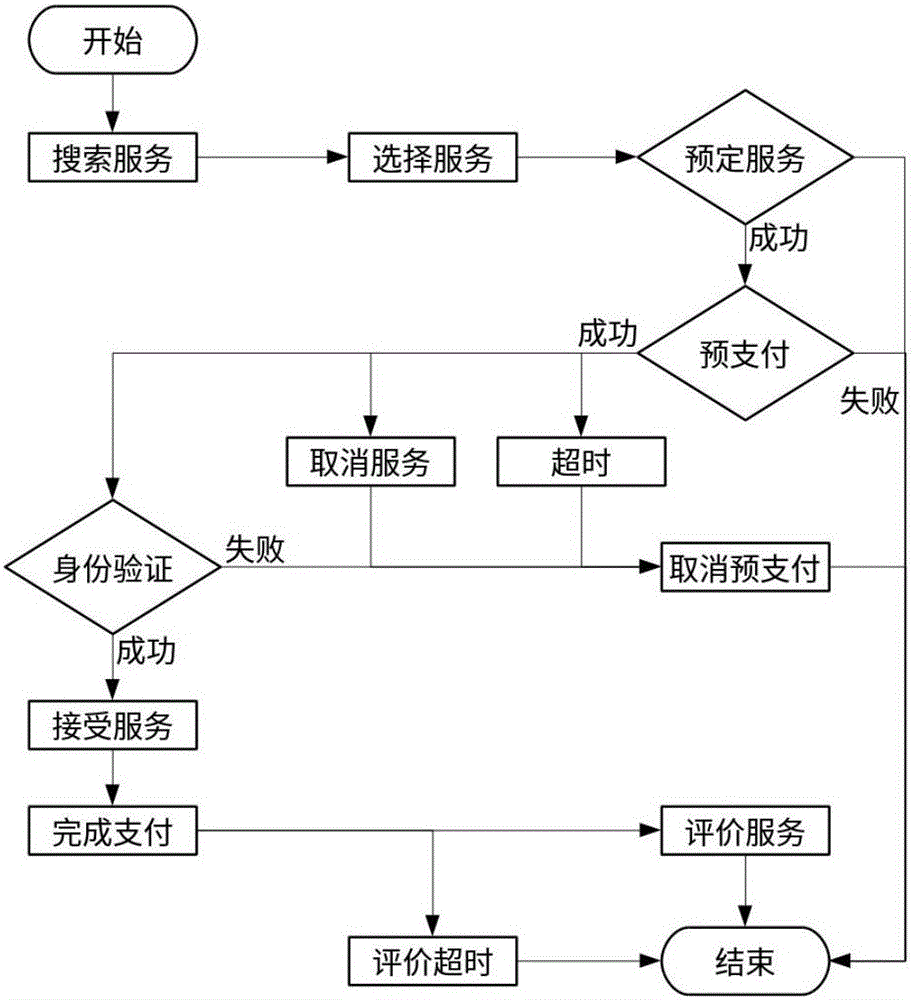

Service ordering method and service ordering platform

InactiveCN105701740AFair and secure payment modelReduce waiting timeData processing applicationsService provisionPayment service provider

The invention relates to a service ordering method and a service ordering platform. The service ordering method comprises the steps of transmitting preset service request information by a service requiring party to a service ordering platform; after receiving preset service request information by a service ordering platform, transmitting preset service request information to a service provider; querying a preset task by the service provider, and filtering the service requiring party and filtering the preset task of the service requiring party; paying advance payment of a preset task by the service requiring party to the service provider in preset time period, confirming successful order establishment and establishing a bidirectional chain table through the service ordering platform; reading information in the bidirectional chain table by the service provider, establishing an identity verification system; keeping the service requiring party and the service provider operate in an allowed or preset time period until time is up, and after transaction, paying cost by the service requiring party to the service provider through the service ordering platform. The service ordering platform comprises a terminal logging-on module, a service searching module, a service provider filtering module, a payment module, an identity verification module, an evaluation module and a platform processing module.

Owner:吴江

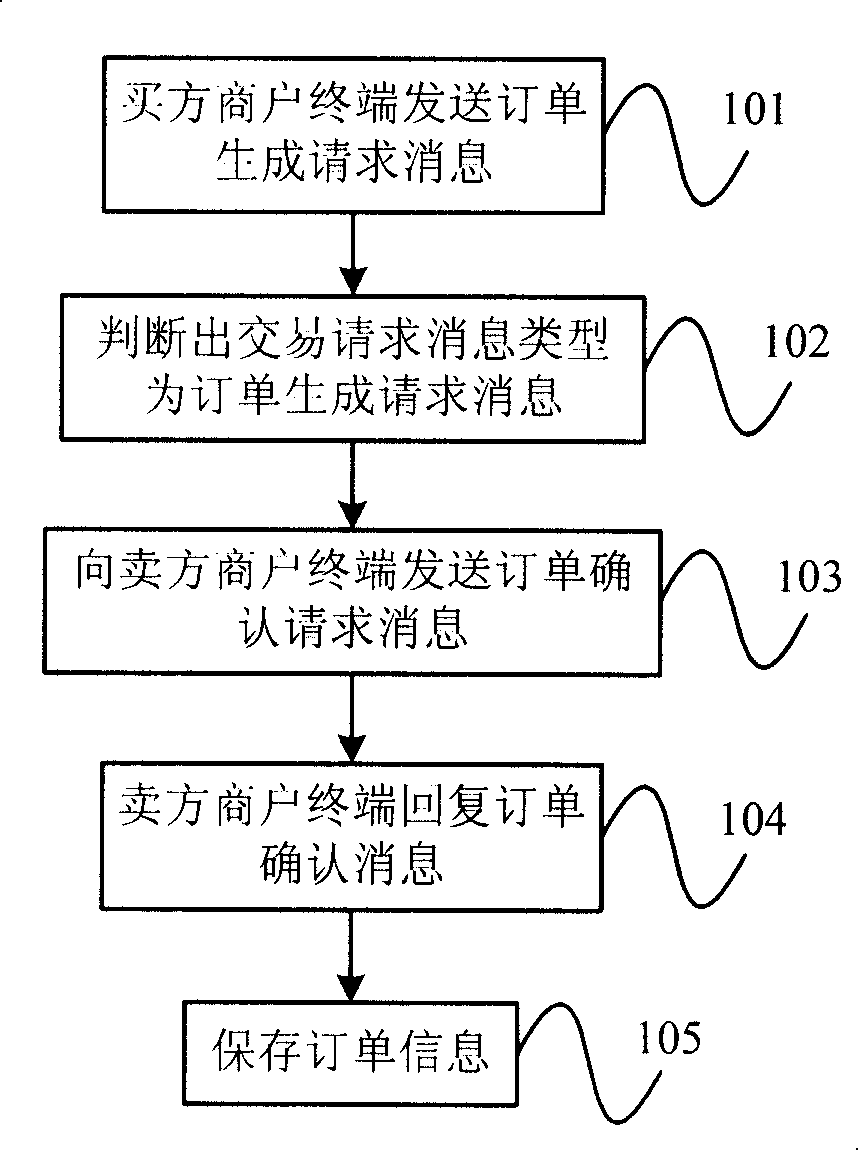

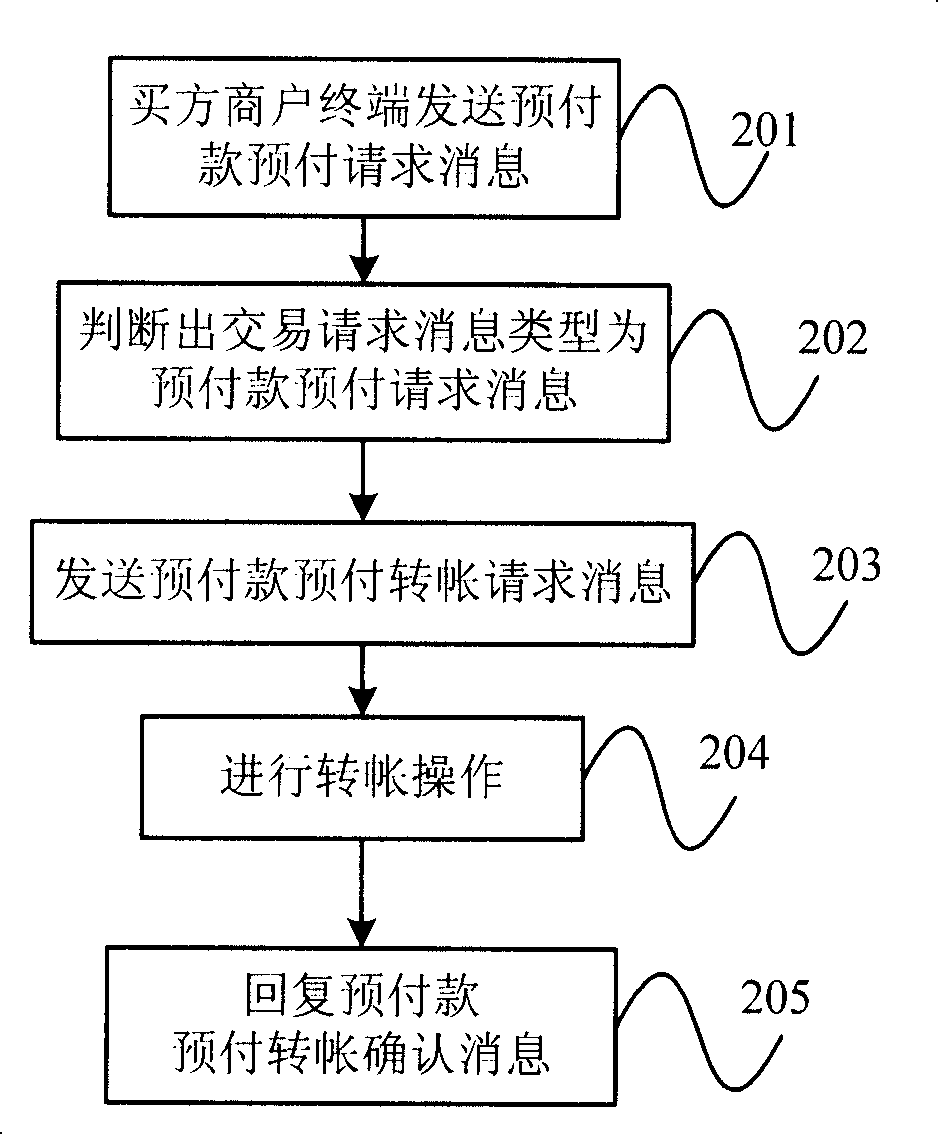

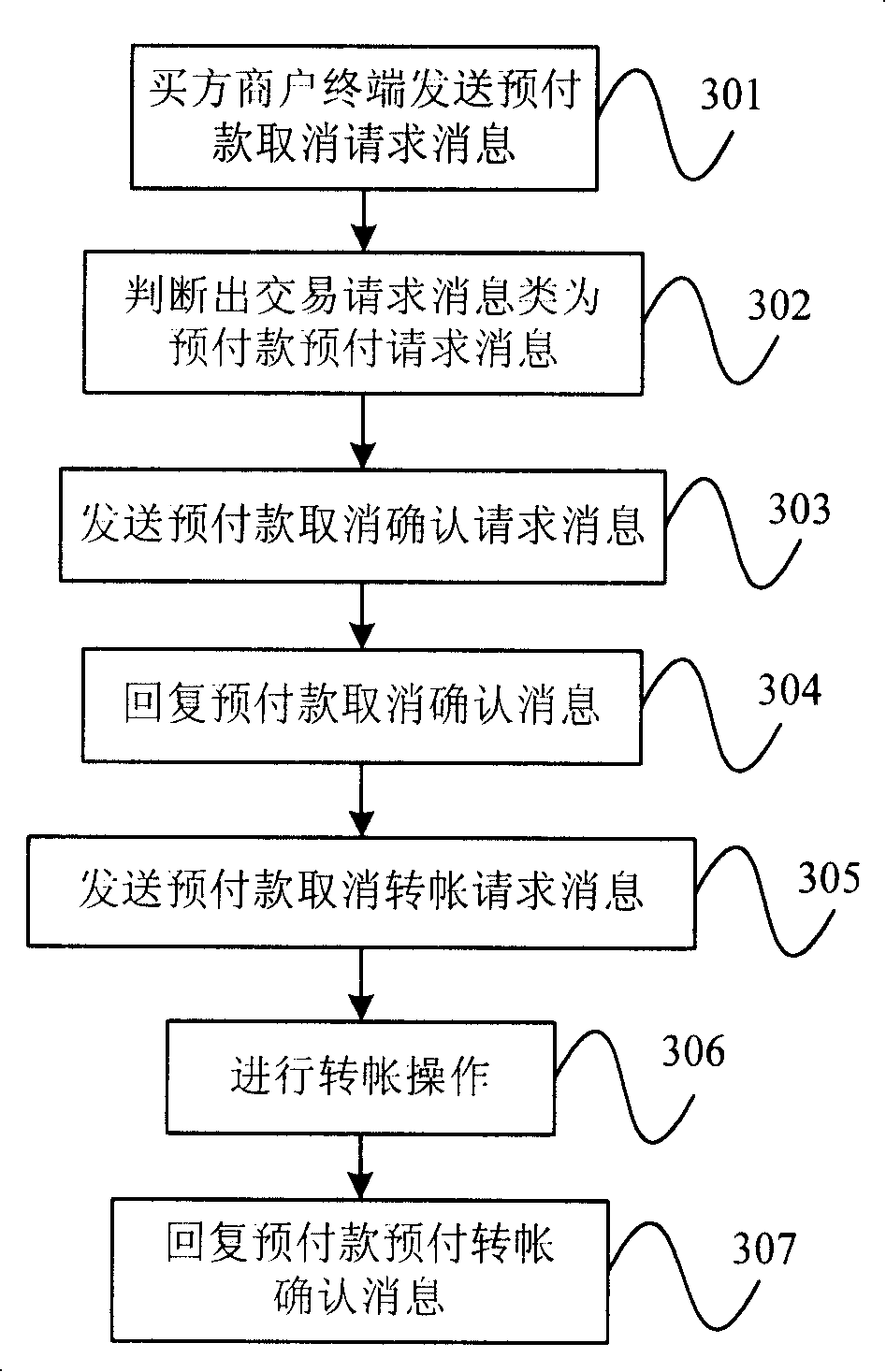

Trading information processing method

InactiveCN101162518ASafety managementAvoid difficultiesFinanceCommerceInformation processingBank account

The invention relates to a business transaction information processing method which includes the following steps: a bank payment system judges received transaction request information; if the information is order formation request information, the bank payment system stores the order information after receiving the order confirmation information transmitted by a seller terminal; if the information is advanced payment request information, the bank payment system inquires corresponding order information and transmits transfer request information to a bank account system for transfer operation. Based on the steps, both a buyer and a seller can pay advance payment to a bank which serves as the transaction guarantee agency in B2B electronic commerce; moreover, with higher public reputation, banks ensures safer and more reliable transaction process along with convenient payment and settlement, thereby promoting successfulness of transaction.

Owner:MINSHENG BANKING CORP

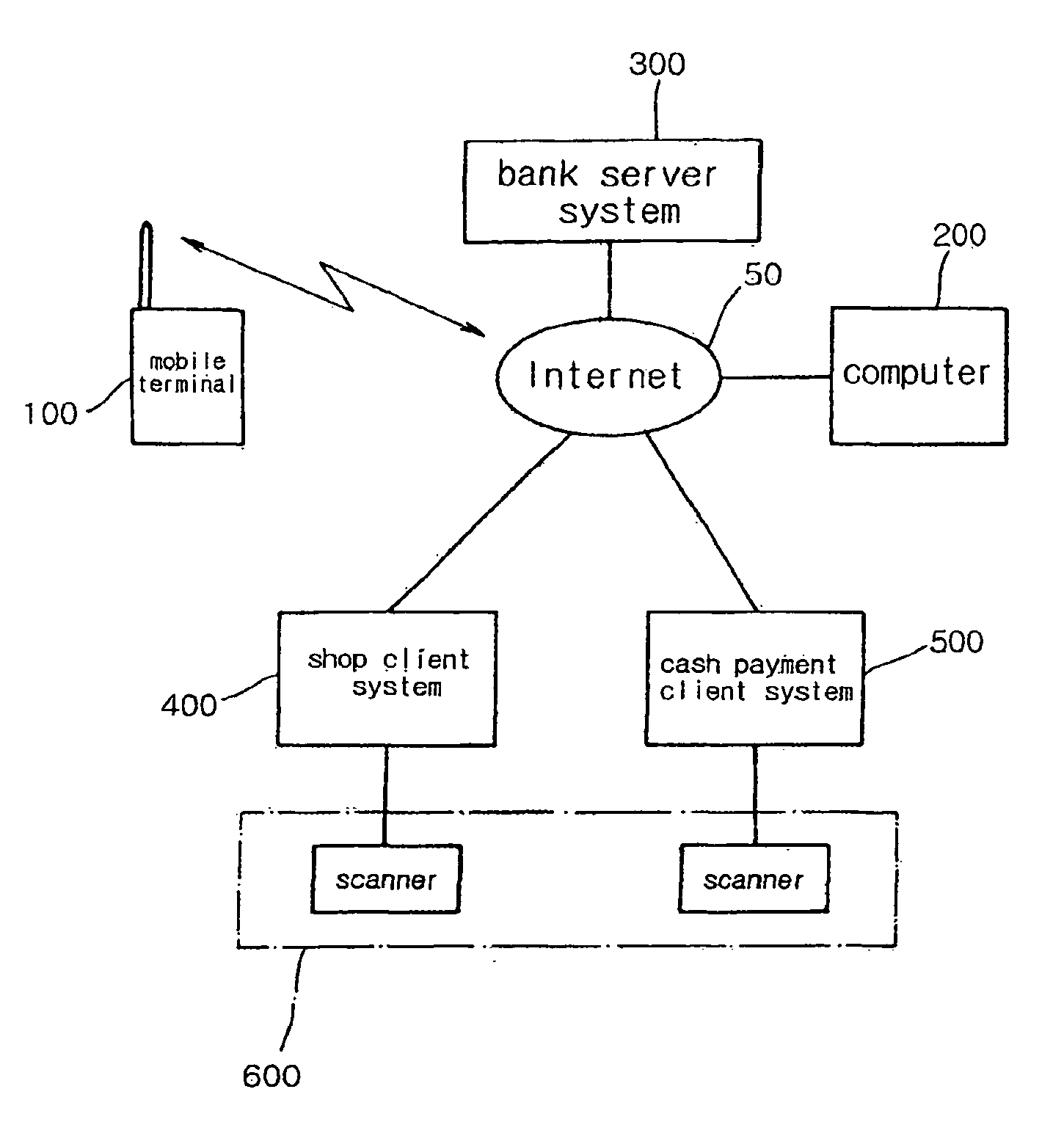

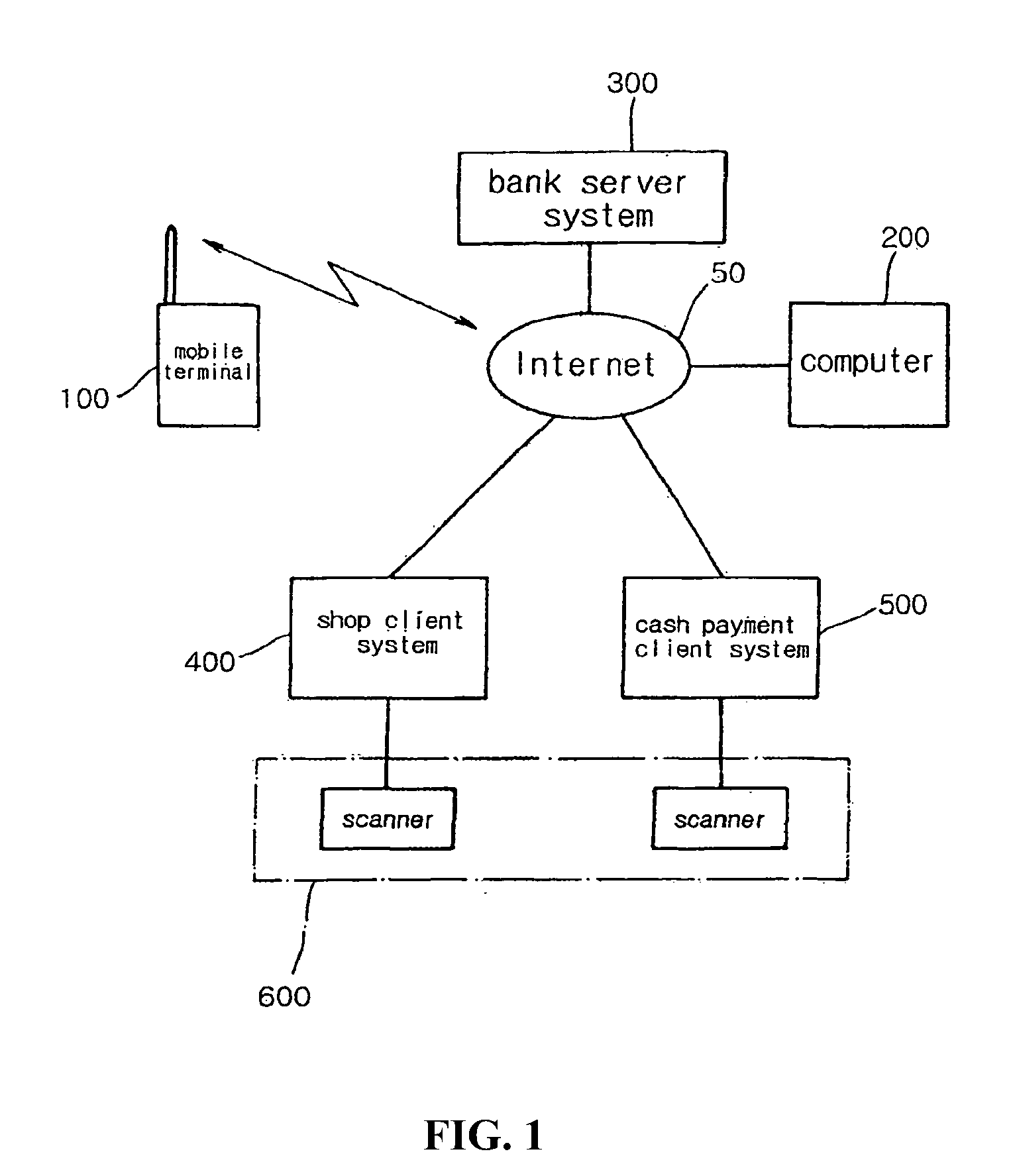

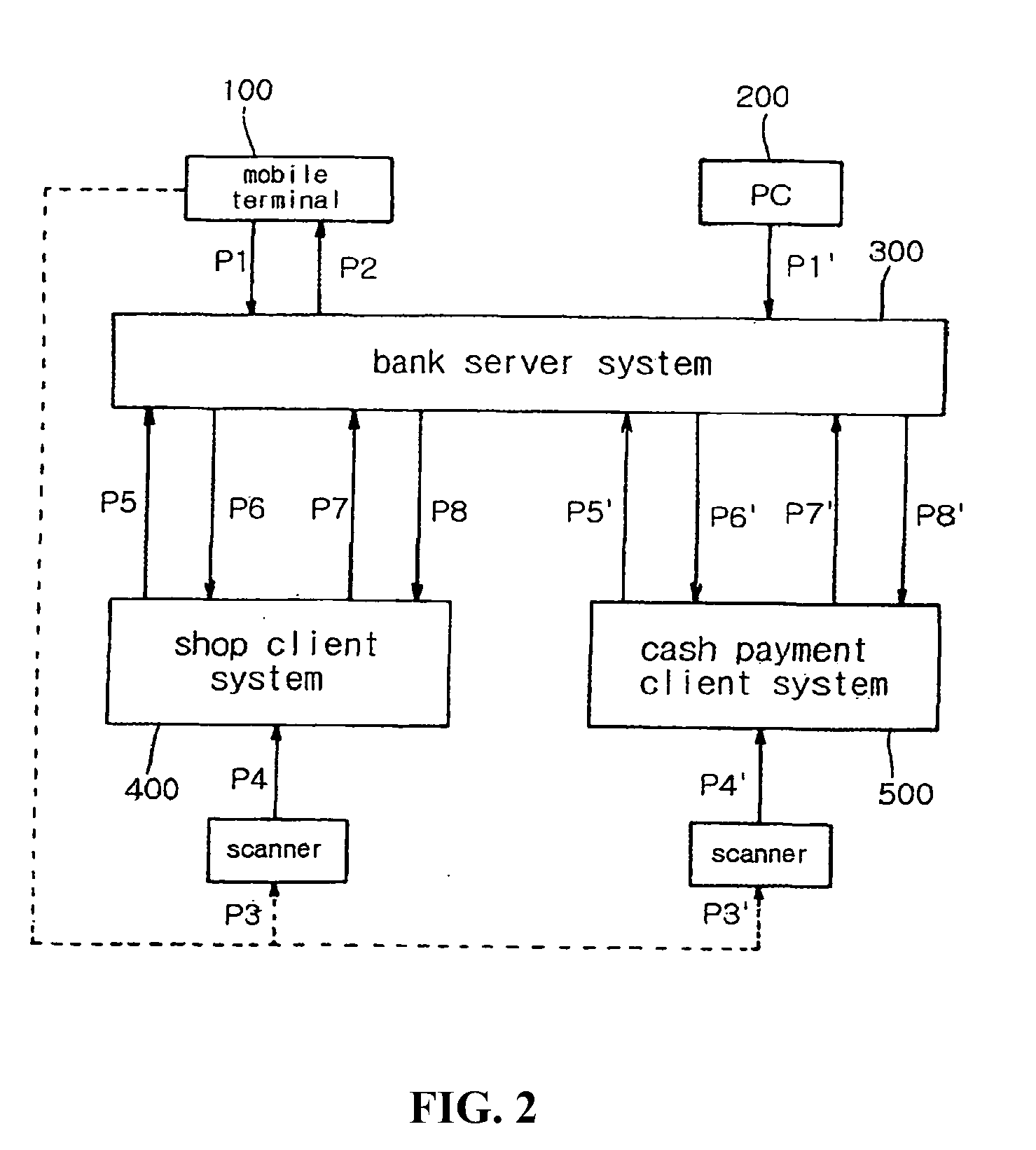

Electronic settlement system, electronic settlement method and cash paying method using LCD barcode displayed on mobile terminal

Owner:PANTECH CO LTD

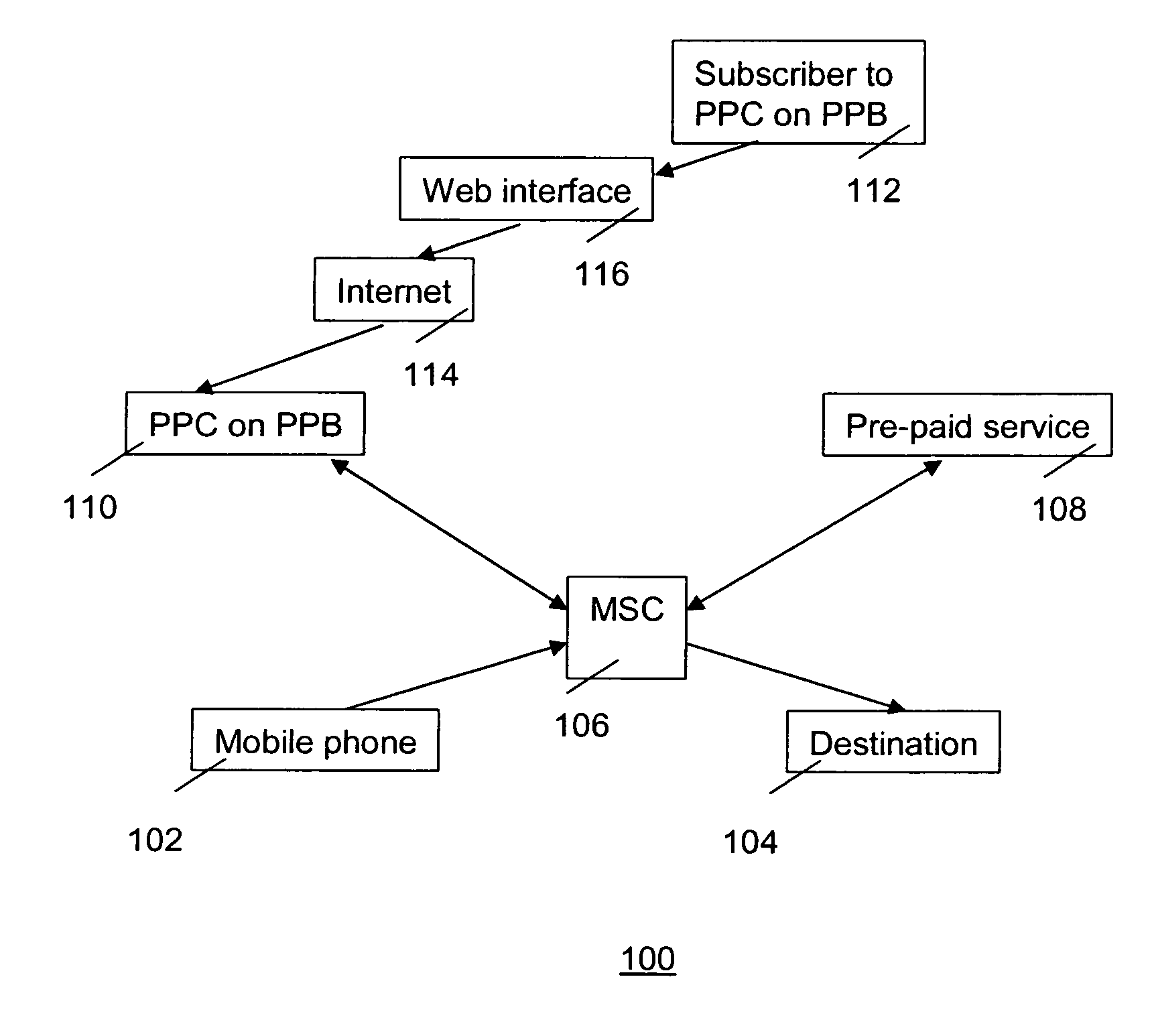

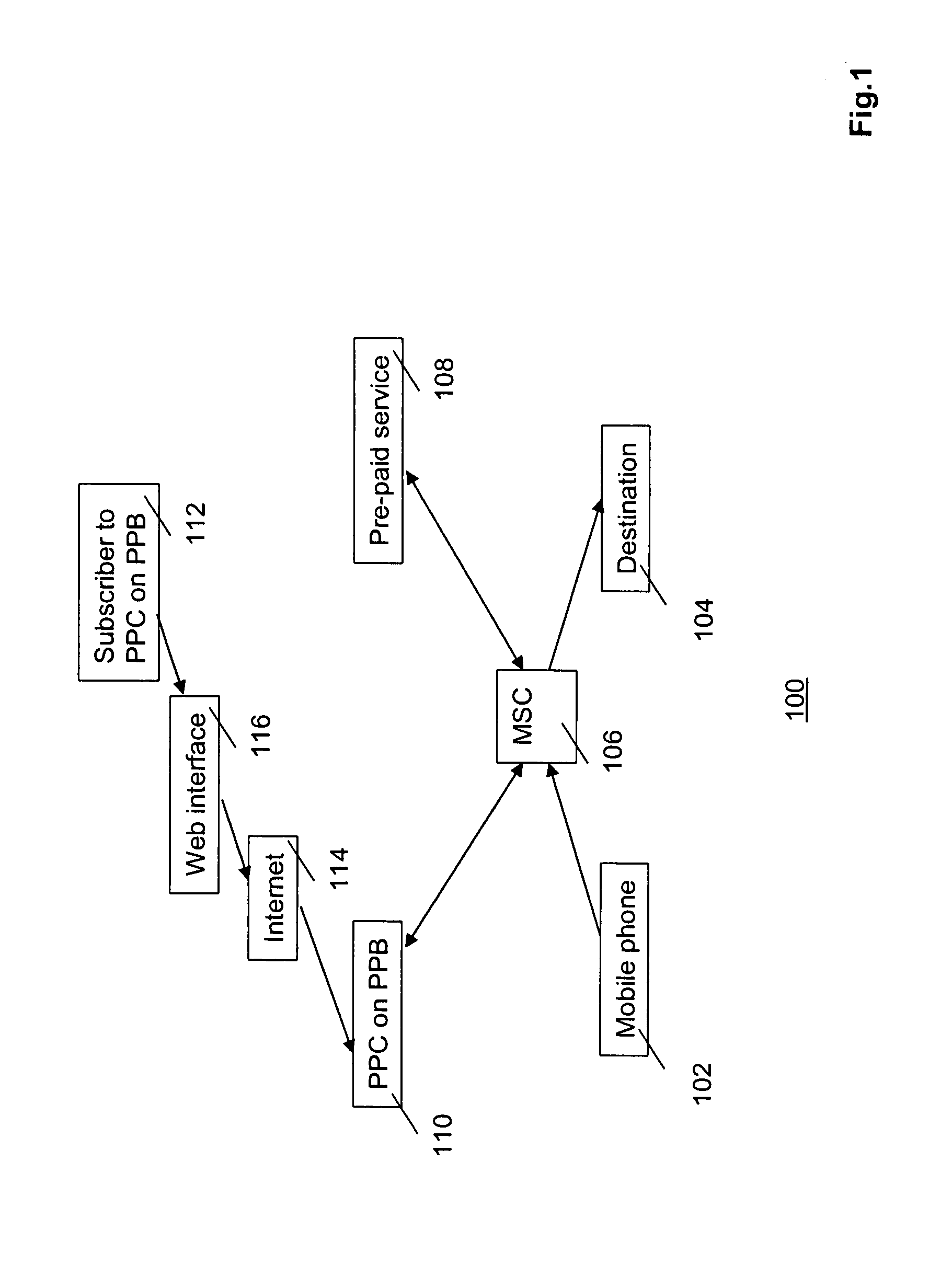

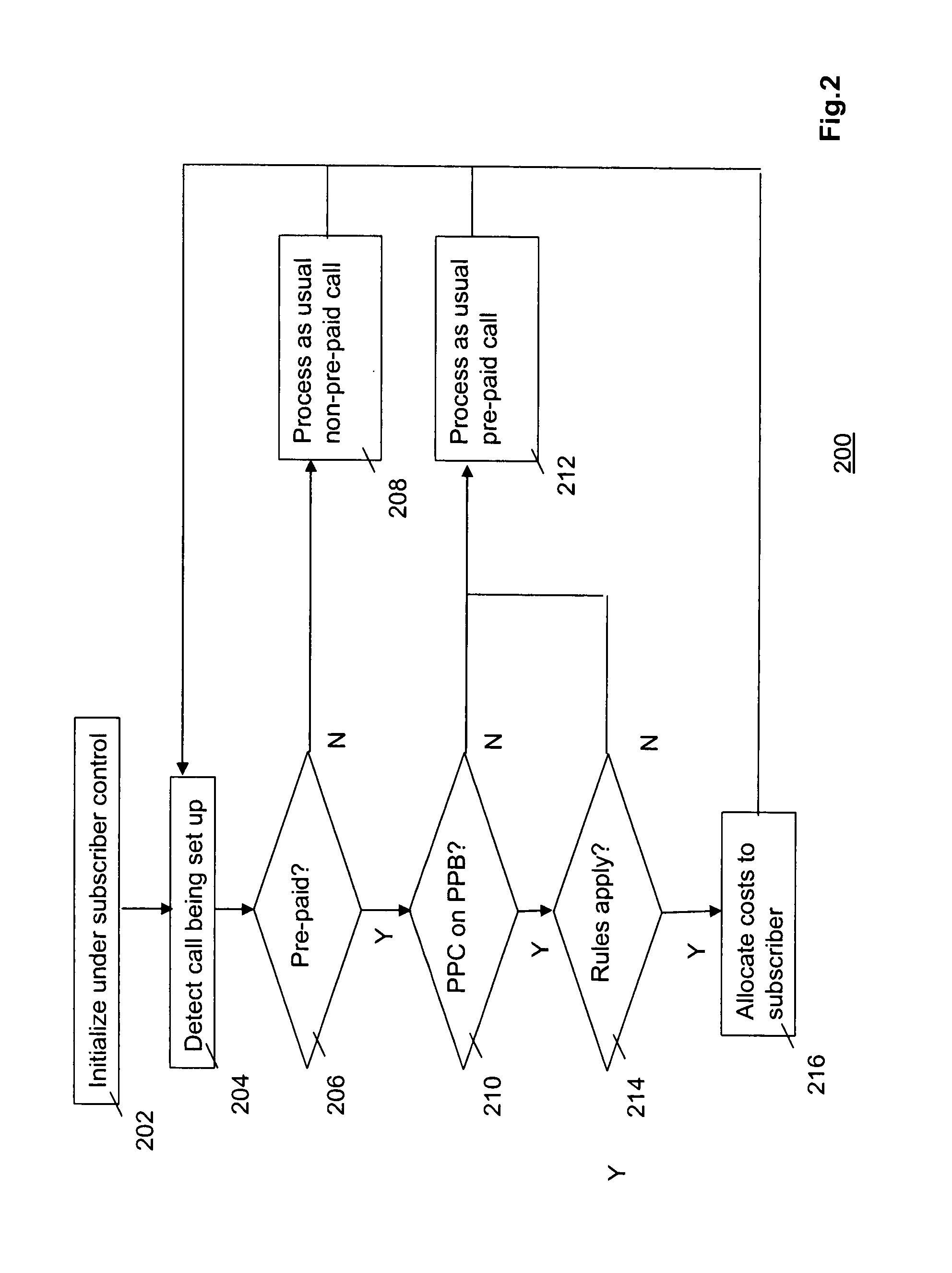

Method and System For Prepaid Calls on Postpaid Bills

InactiveUS20080268812A1Easy to integrateAvoid changeAccount details/uasgePrepaid telephone callAdvance payment

Owner:KONINK KPN NV

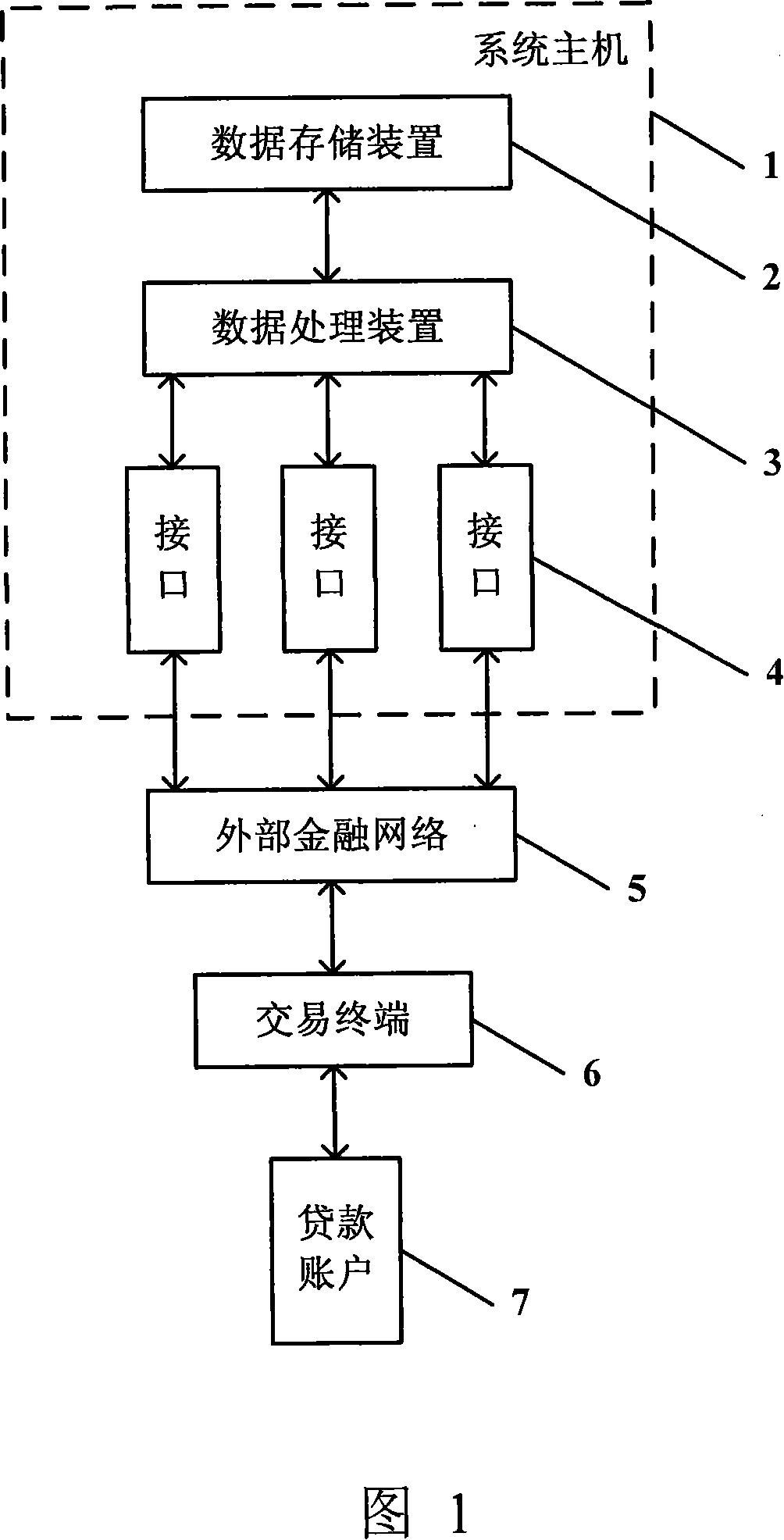

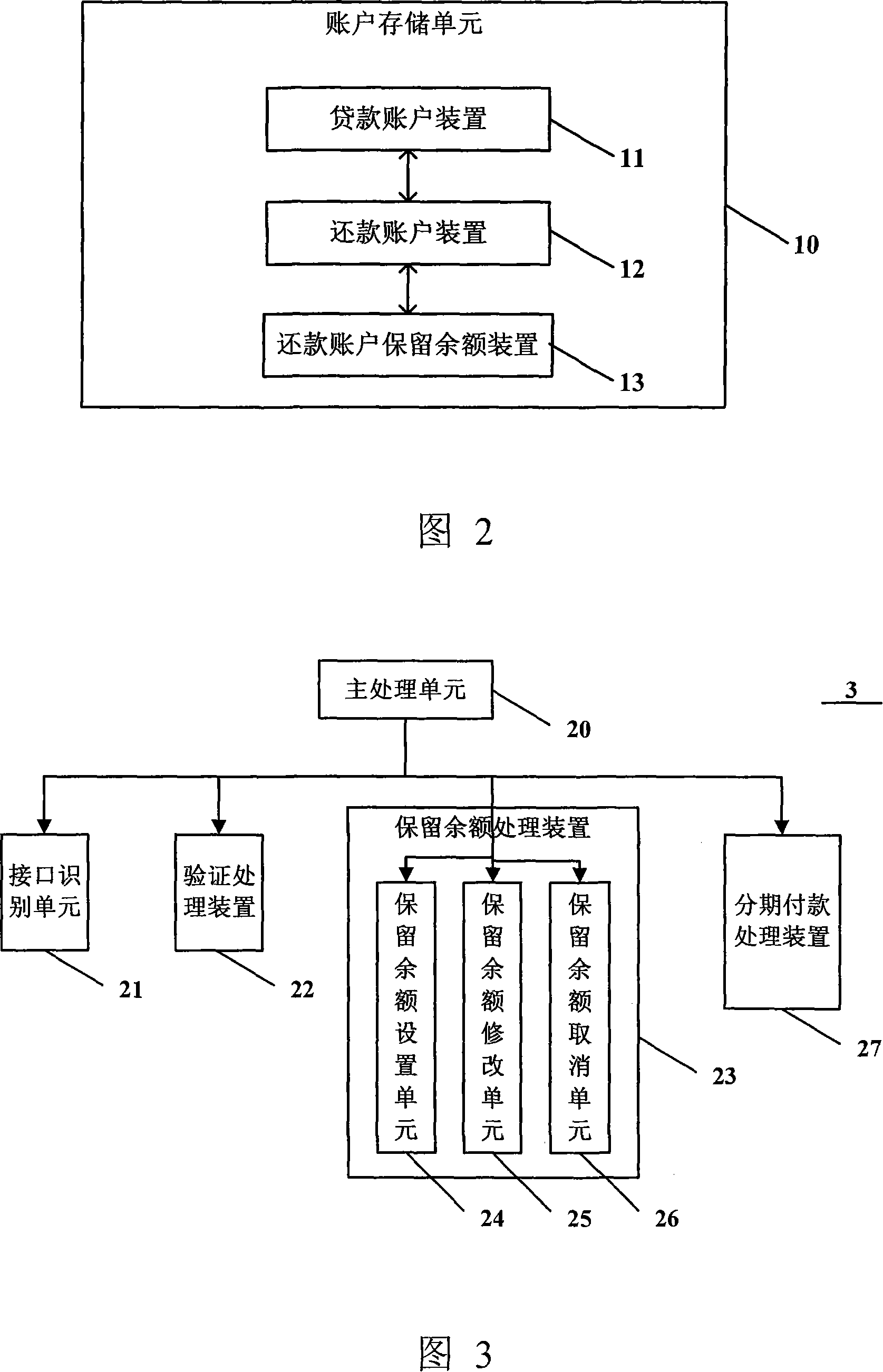

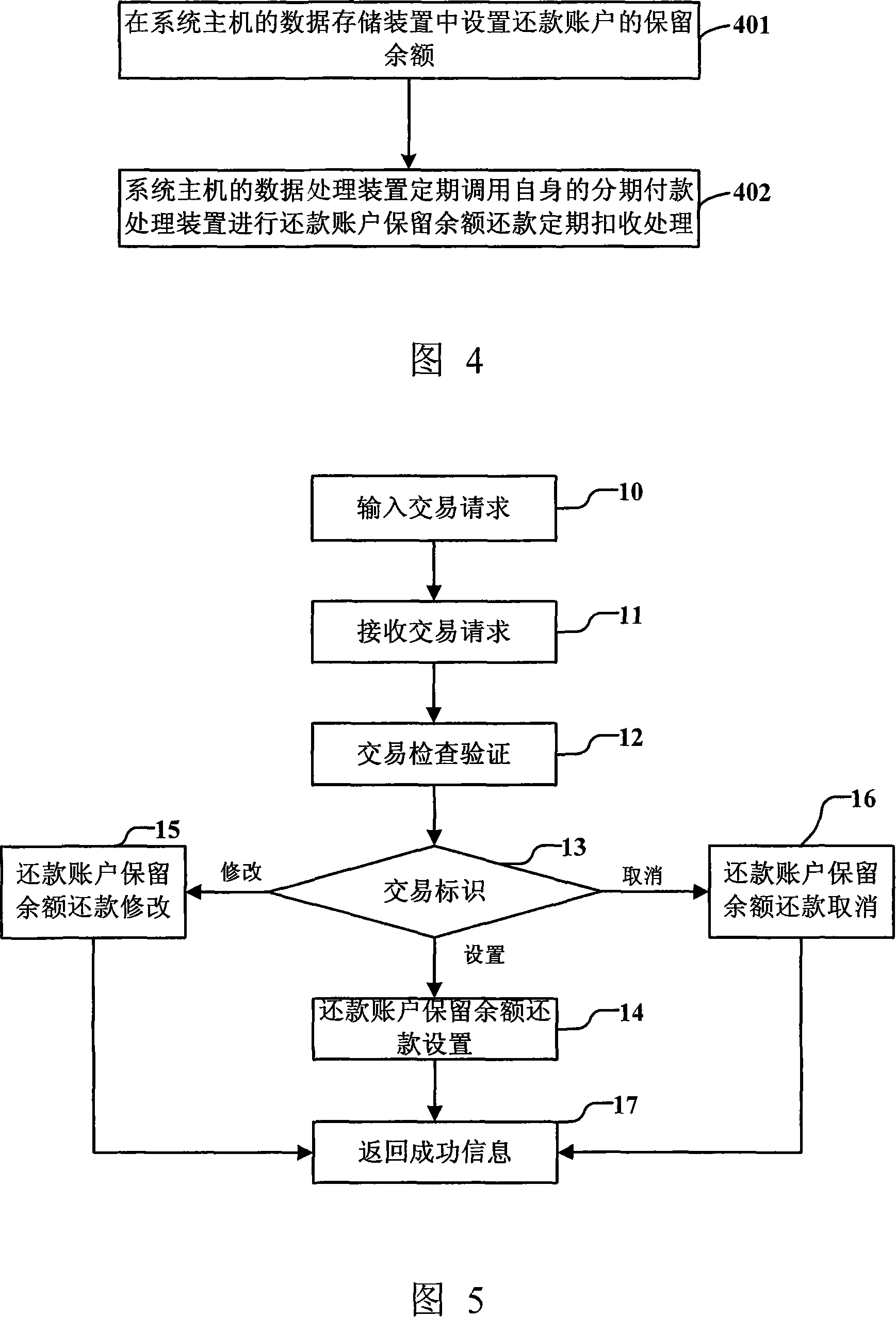

Reserving transfer accounts processing system used for realizing advanced repayment

InactiveCN101140683AImprove service levelQuick take backComplete banking machinesComputer scienceTreatment system

The invention discloses a processing system and method for realizing advance repay transferring to the appointed account, which comprises a transaction terminal used for setting obligated balance of the payment account through external financial network, and a system host for deducting account from the payment account's obligated balance. The processing steps are composed of: calculating the deposit and interest prior to the scheduled date of repayment to judge whether the available balance is more than the sum of the deposit and interest that are required to be repaid before the scheduled date as well as the obligated balance. If more, the advance repay will be taken into effect to deduct the deposit and interest of current period from the available balance, and then deduct the advance payment which is the difference between the balance after deduction and the said obligated balance. The invention is characterized in realizing flexible and convenient advance repay, not only facilitating clients but also improving the banking service.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

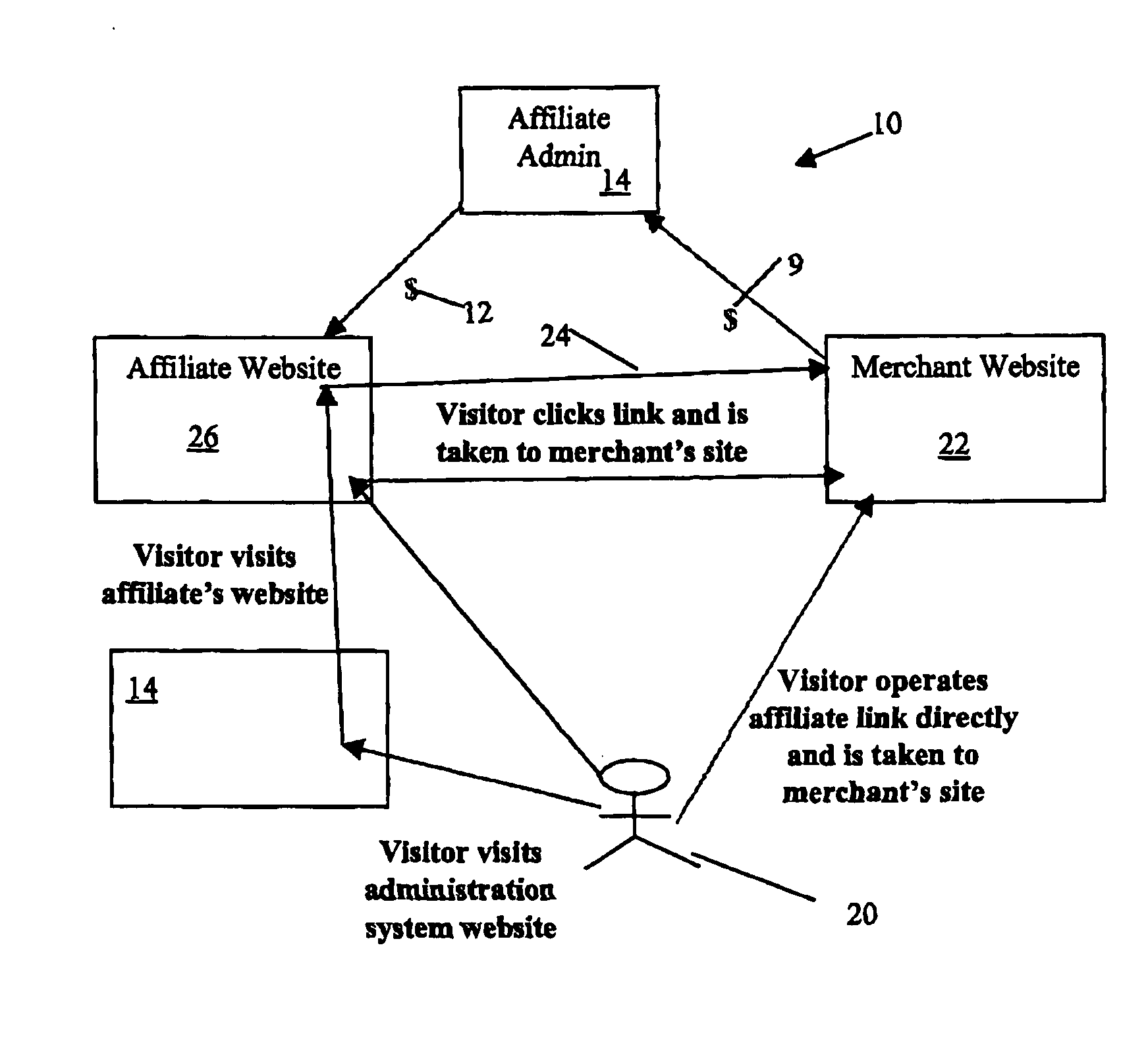

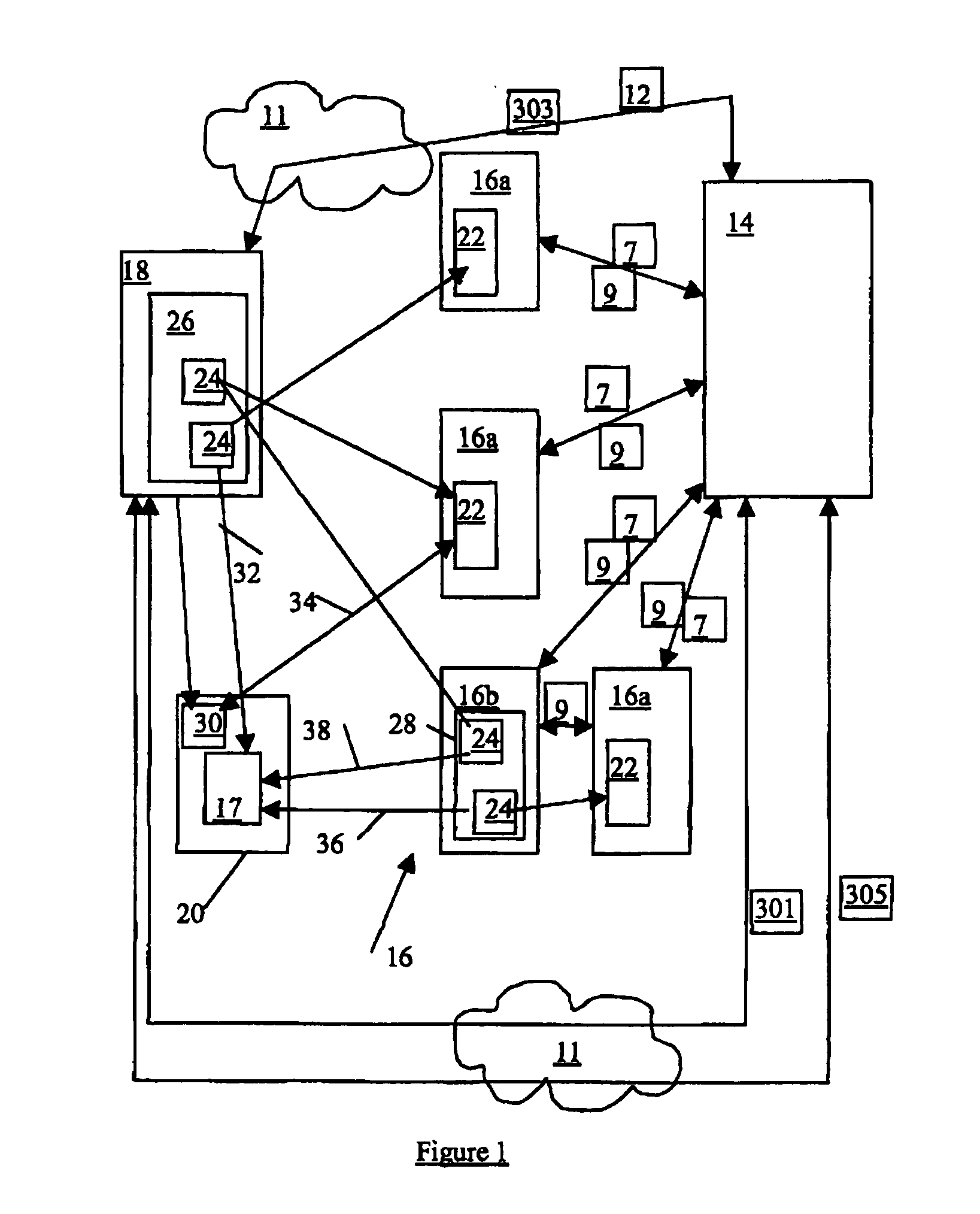

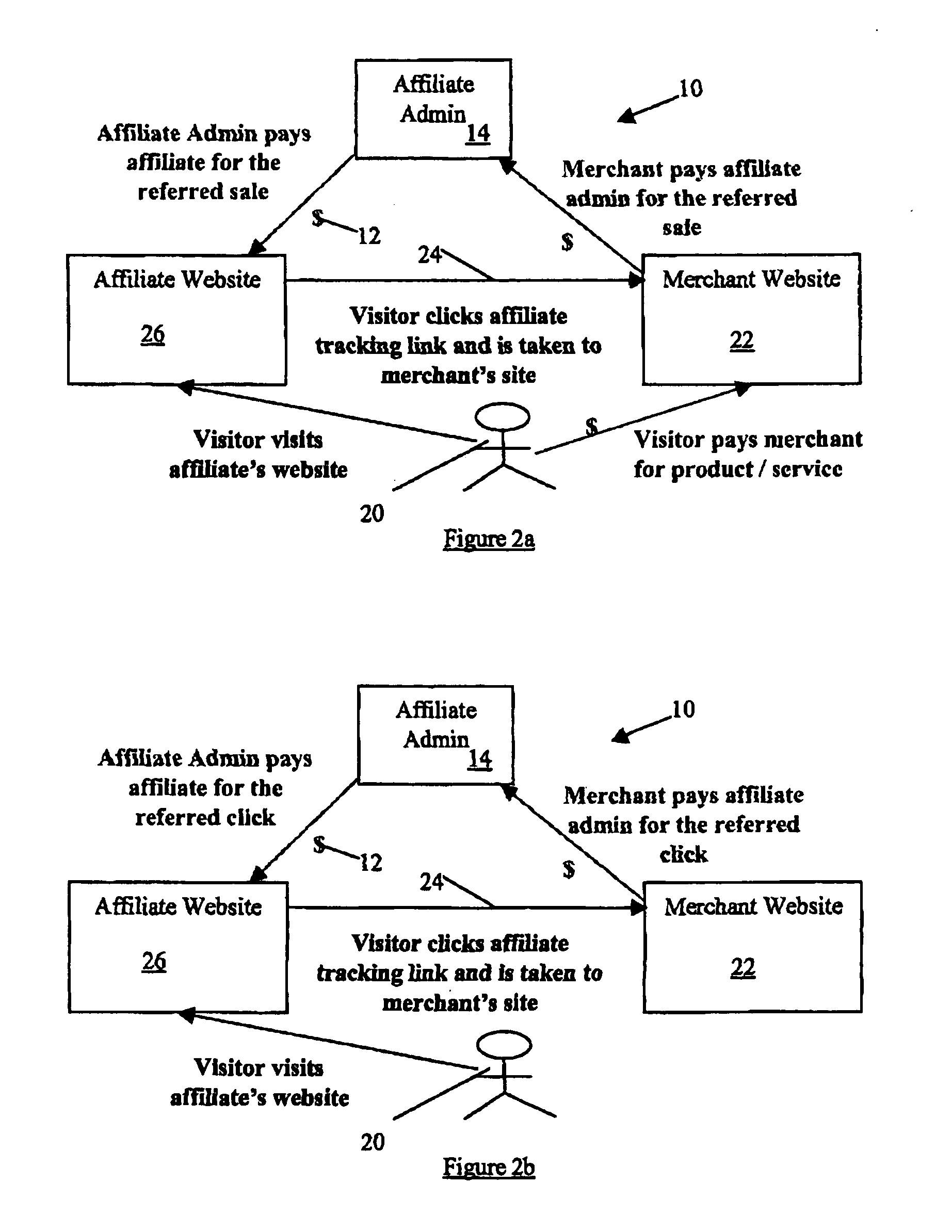

Advancing payment to an affiliate based on company electronic link activity

A method for advancing payment of a portion of one or more amounts due under an affiliate program to an affiliate, the amount being owed by a merchant of a website subject to the affiliate program. The method includes the steps of, first, providing a means for transmitting information to an administrator. The information is for use by the administrator to verify the affiliate's identity. Second, the method provides a means for enabling the administrator to verify the identify of the affiliate based on the information. Third, the method provides a means whereby the affiliate assigns the amount due under the affiliate program absolutely to the administrator, and whereby the affiliate requests that the portion of the amount due be advanced. Next, the method provides confirmation from the merchant that the amount due under the affiliate program is assigned absolutely to the administrator. Finally, the method provides a means for enabling the administrator to effect payment to the affiliate of the portion of the amount due under the affiliate program.

Owner:KHANDELWAL HARSCH

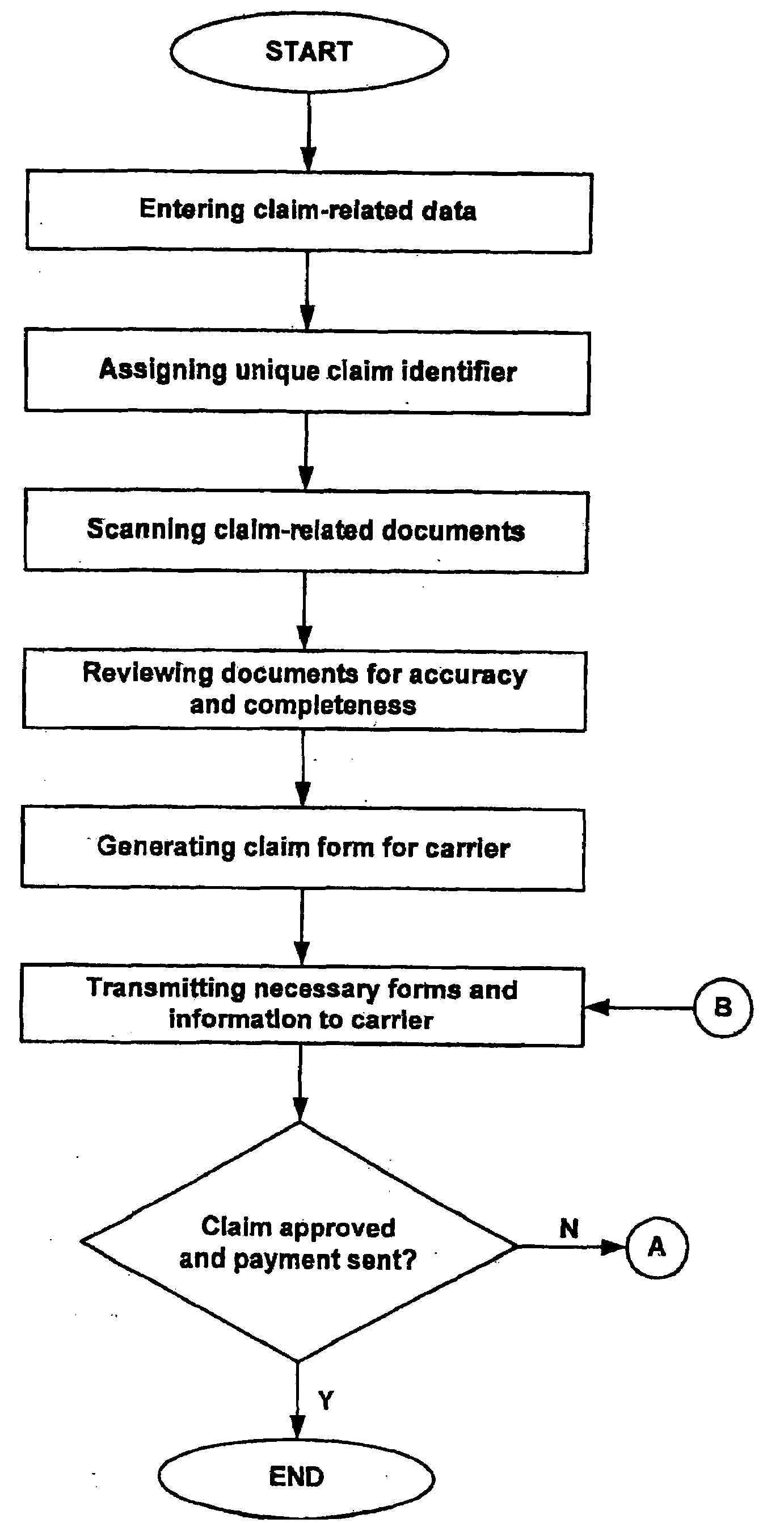

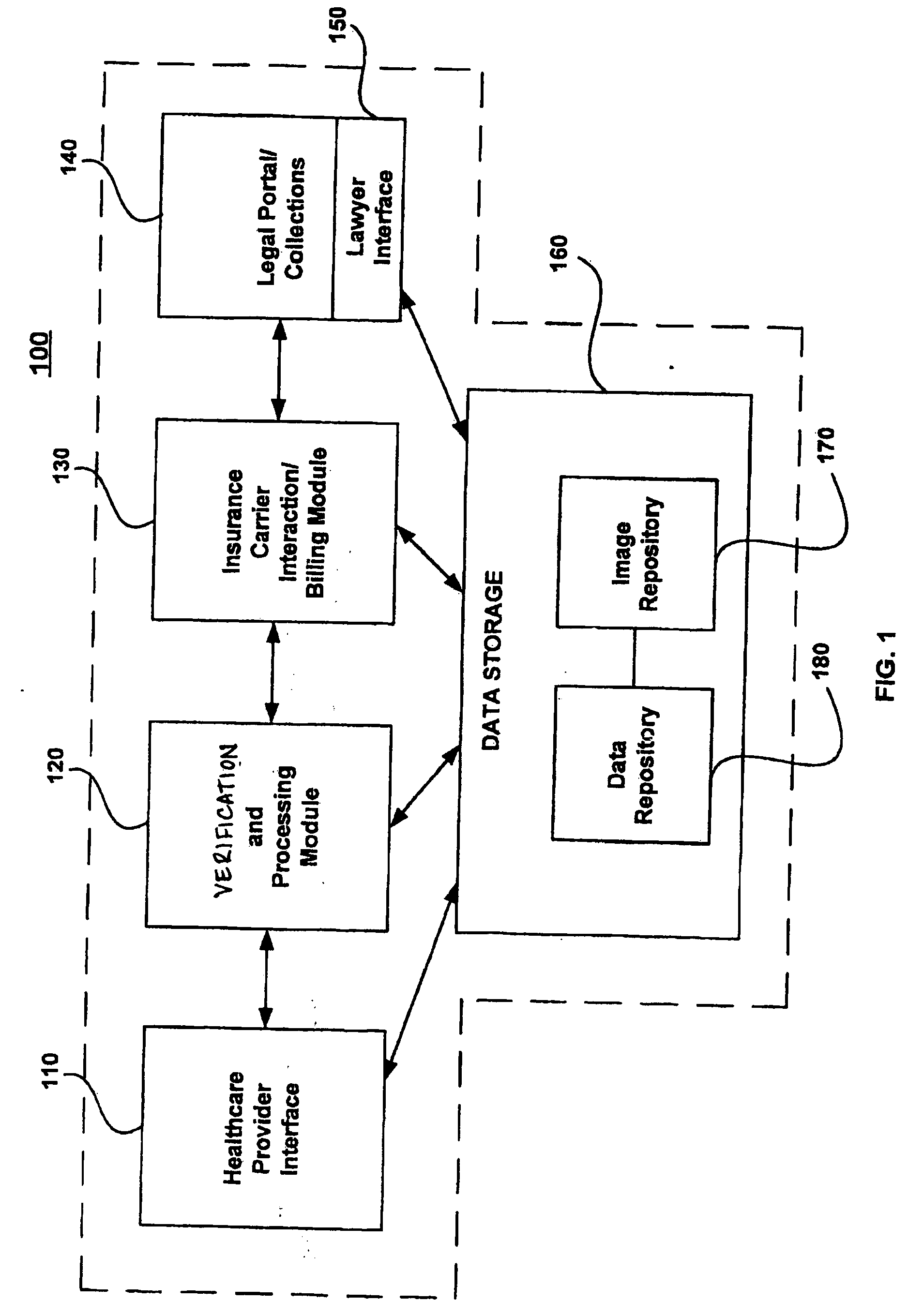

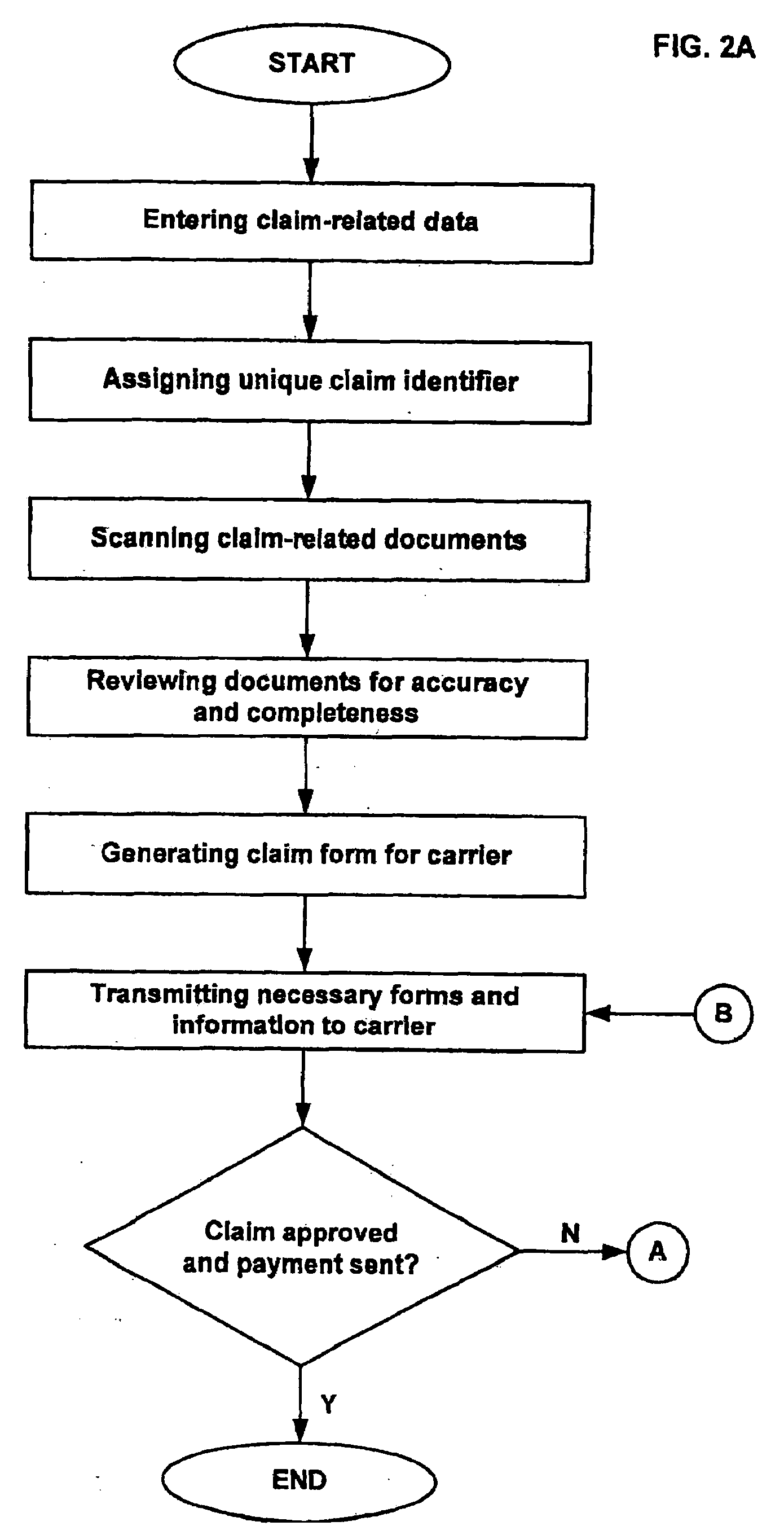

Integrated method and system for claim submission, processing, resolution and advance funding

InactiveUS20070179818A1Reduce the impactMeet complex requirementsFinanceOffice automationState diagramCourse of action

A method and system for integrated claim processing is provided that includes features and functions for entering claim-related data in a memory, generating a claim form and storing the claim form in the memory, transmitting the claim form to an insurance carrier, determining whether the claim will be paid by the insurance carrier, providing advance funding to the claimant, and deciding appropriate course of action on the basis of the determination. A method and system for undertaking a legal action that includes preparing a demand letter, transmitting the demand letter to the insurance carrier, generating an attestation of service as proof of transmittal, selecting an attorney from a list of available attorneys, determining venue and cause of action, filing a lawsuit, and maintaining a state diagram indicating the current status of the case.

Owner:MEDTRX CAPITAL

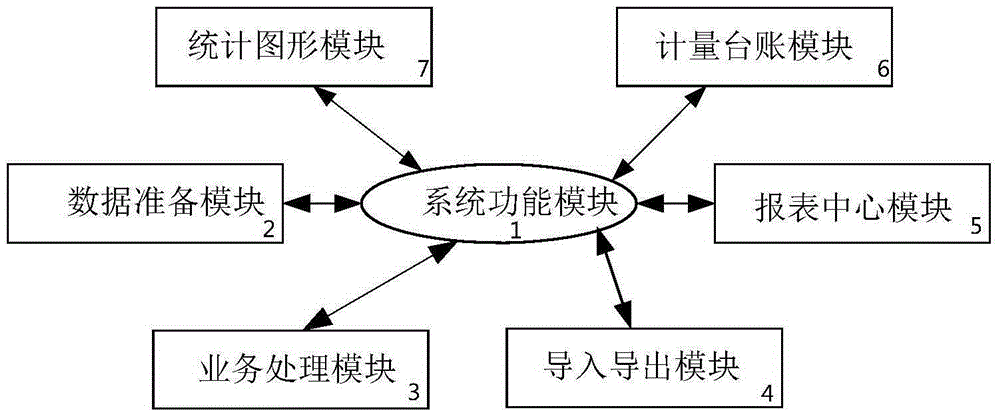

Measurement and payment management system and method thereof

InactiveCN105389661APrevent malicious tampering list unit priceEnsure safetyResourcesInstant messagingAuthentication

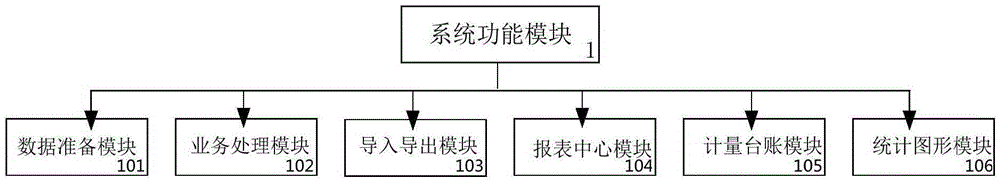

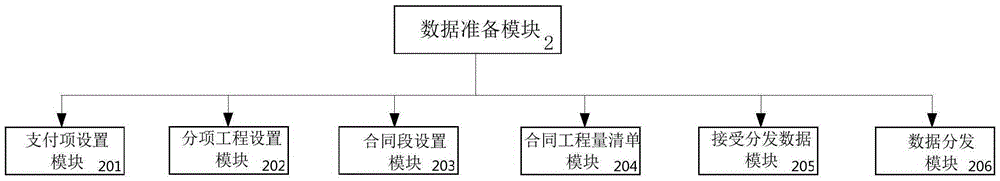

The invention relates to a measurement and payment management system and a method thereof. A system function module is used for role authorization management, identity authentication, instant messaging IM service, data security protection, event management, data processing, and component and interface services; a data preparation module is used for setting basic data; the business processing module is used for measurement and payment, order change, material advance payment management and construction advance payment management; an import and export module is used for importing and exporting data; a report center module is used for extracting needed project specification data from the business processing module and providing reports; a measurement machine account module is used for cost analysis and machine account analysis; and a statistical graphic module is used for making a statistical graphic switched between a 2D mode and a 3D mode. Engineering measurement and payment can be effectively controlled, measurement is made more accurate and standard through scientific management, and over-measurement and missing measurement are prevented.

Owner:苏州天地微易智能科技有限公司

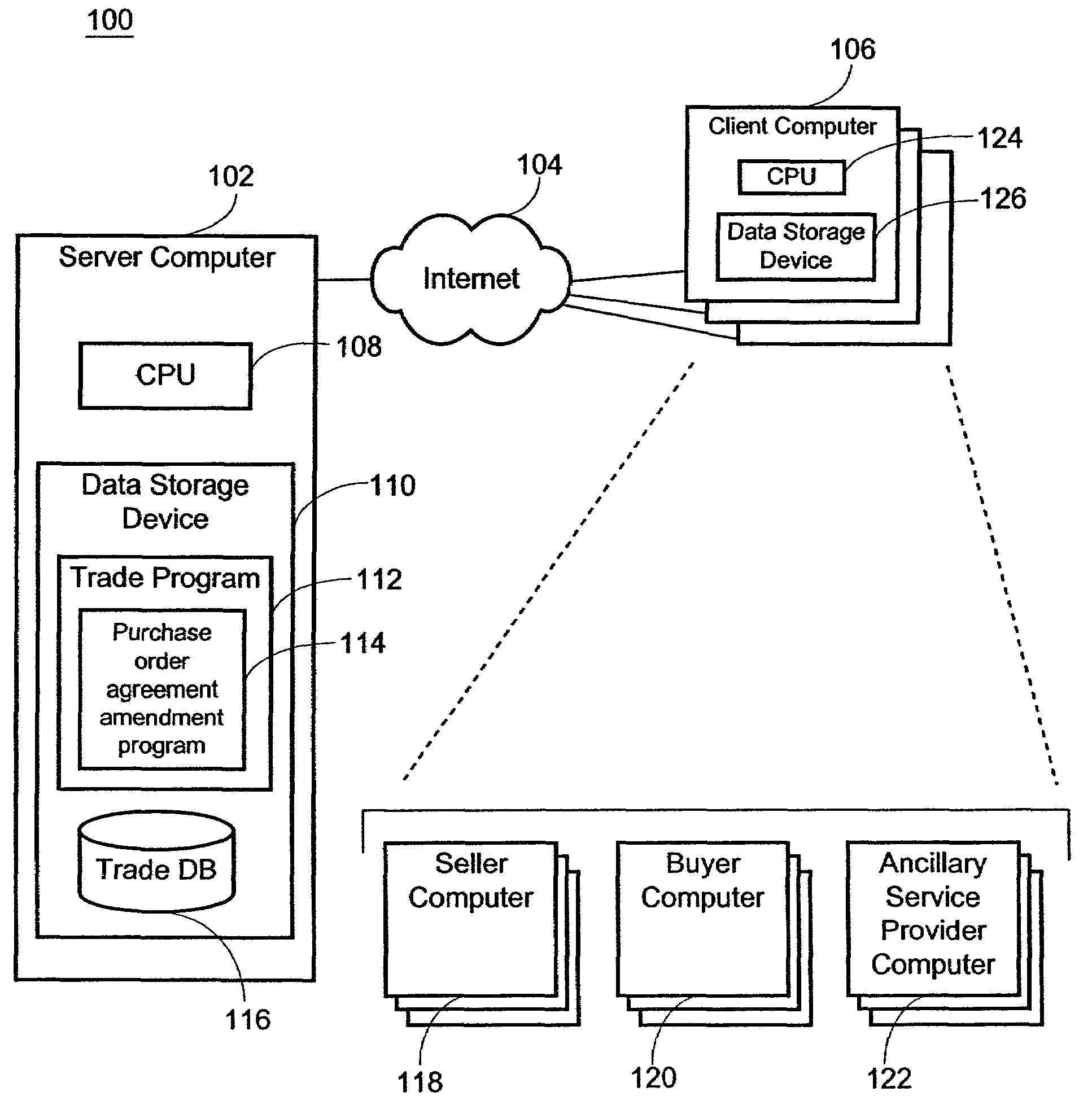

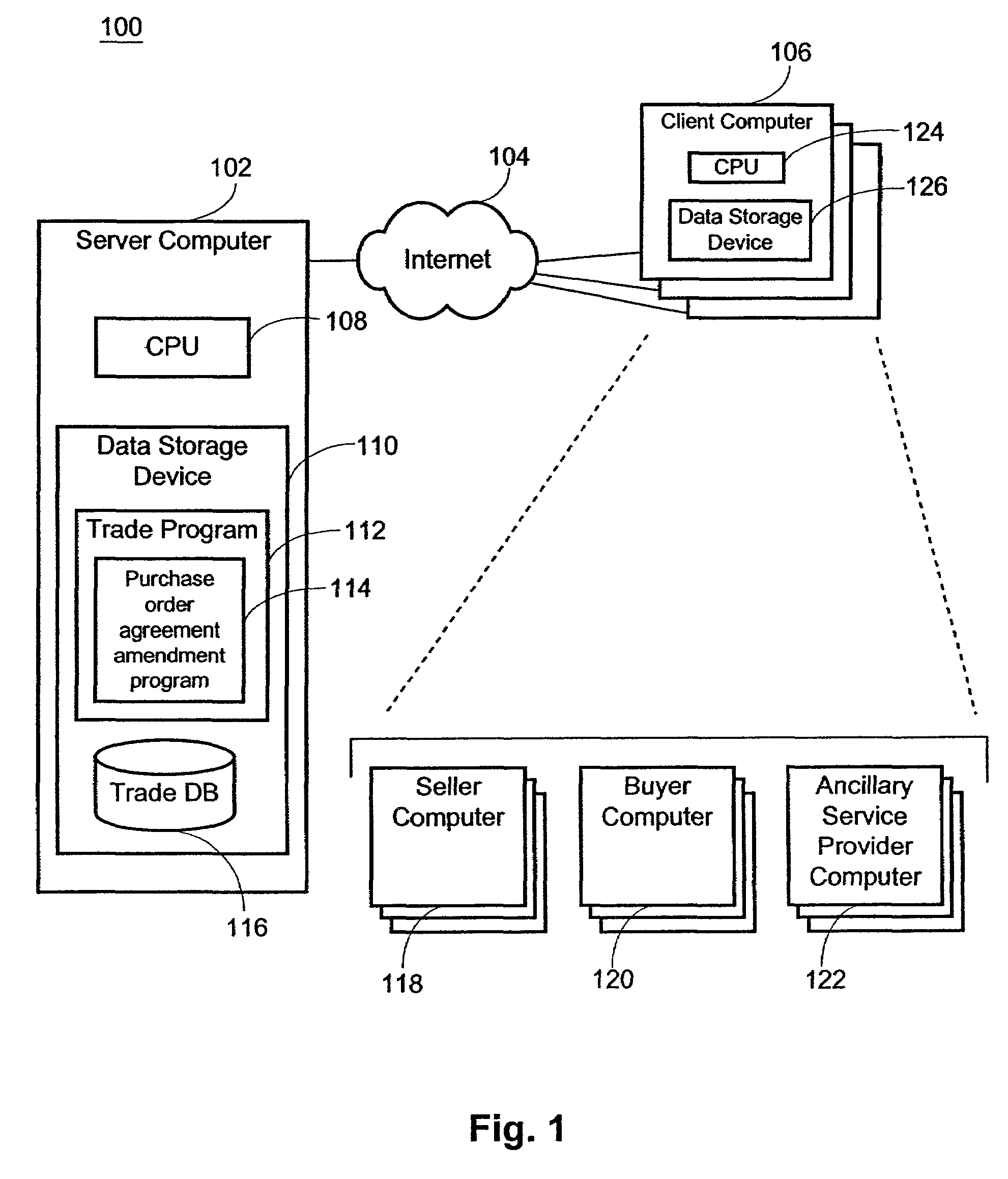

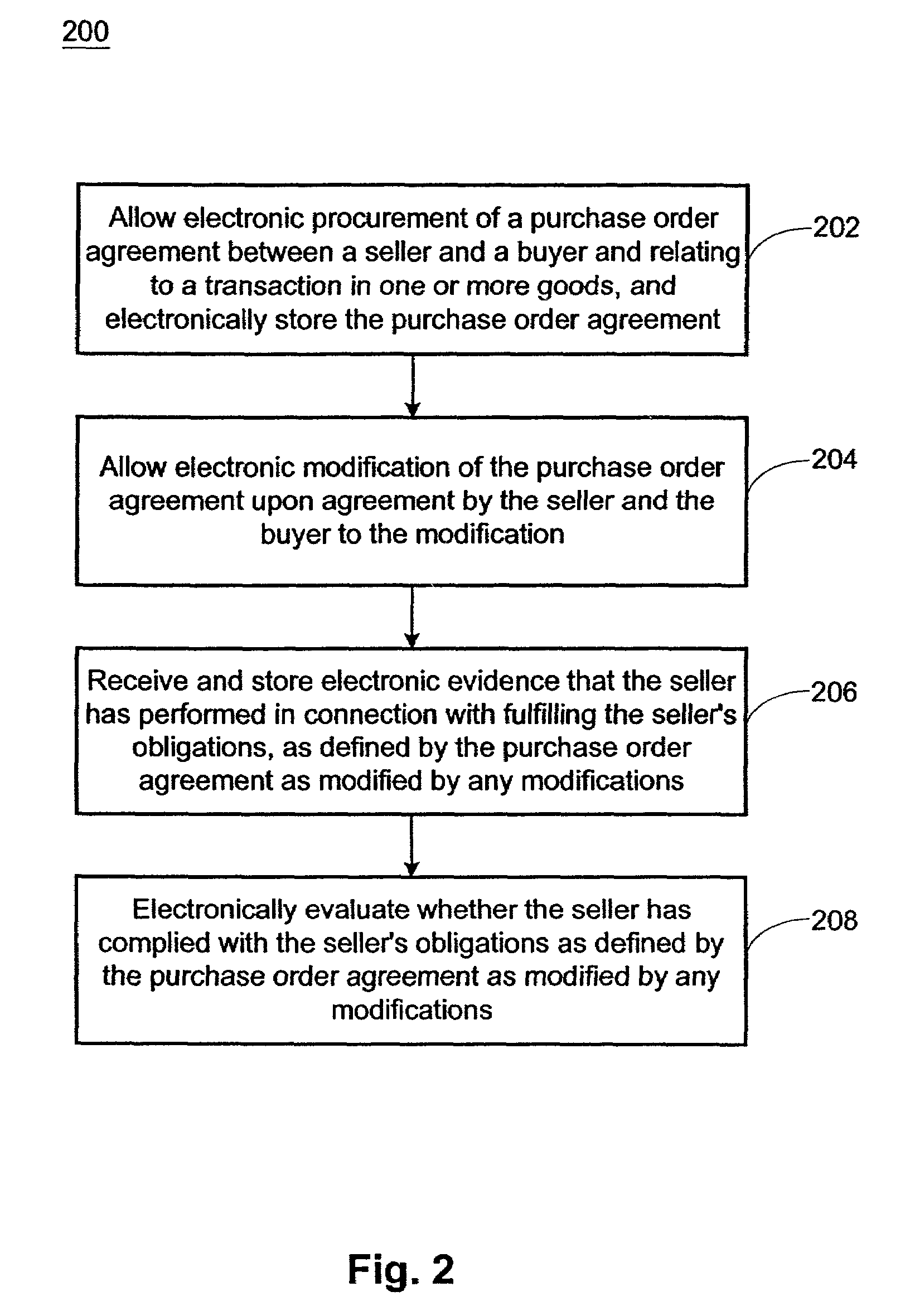

Providing cargo insurance in a full service trade system

The present invention provides a comprehensive, integrated, computerized system for facilitating transactions in goods or services. The system is capable of facilitating transactions from early or initial stages, such as an electronically proposed purchase order, through to later or final stages, such as payment on an invoice or invoices relating to the transaction. The system is integrated to include the participation of various providers of services ancillary to transactions, such as guarantors, insurers, and shippers.The system may allow sellers or buyers to electronically propose amendments and counter-amendments to, and to amend, through mutual agreement, a purchase order agreement. Any amendments are accounted for in later stages of the transaction facilitated by the system. The system may monitor, utilizing stored transaction information, present and anticipated future credit exposures of buyers, and utilizes the buyer credit exposure information for purposes including facilitating providing buyer credit assurance to sellers. The system may facilitate sellers obtaining financing or advance payment relating to transactions. The system may provide opportunities for sellers or buyers to obtain cargo insurance on goods or services shipped in accordance with transactions.

Owner:INFOR US LLC

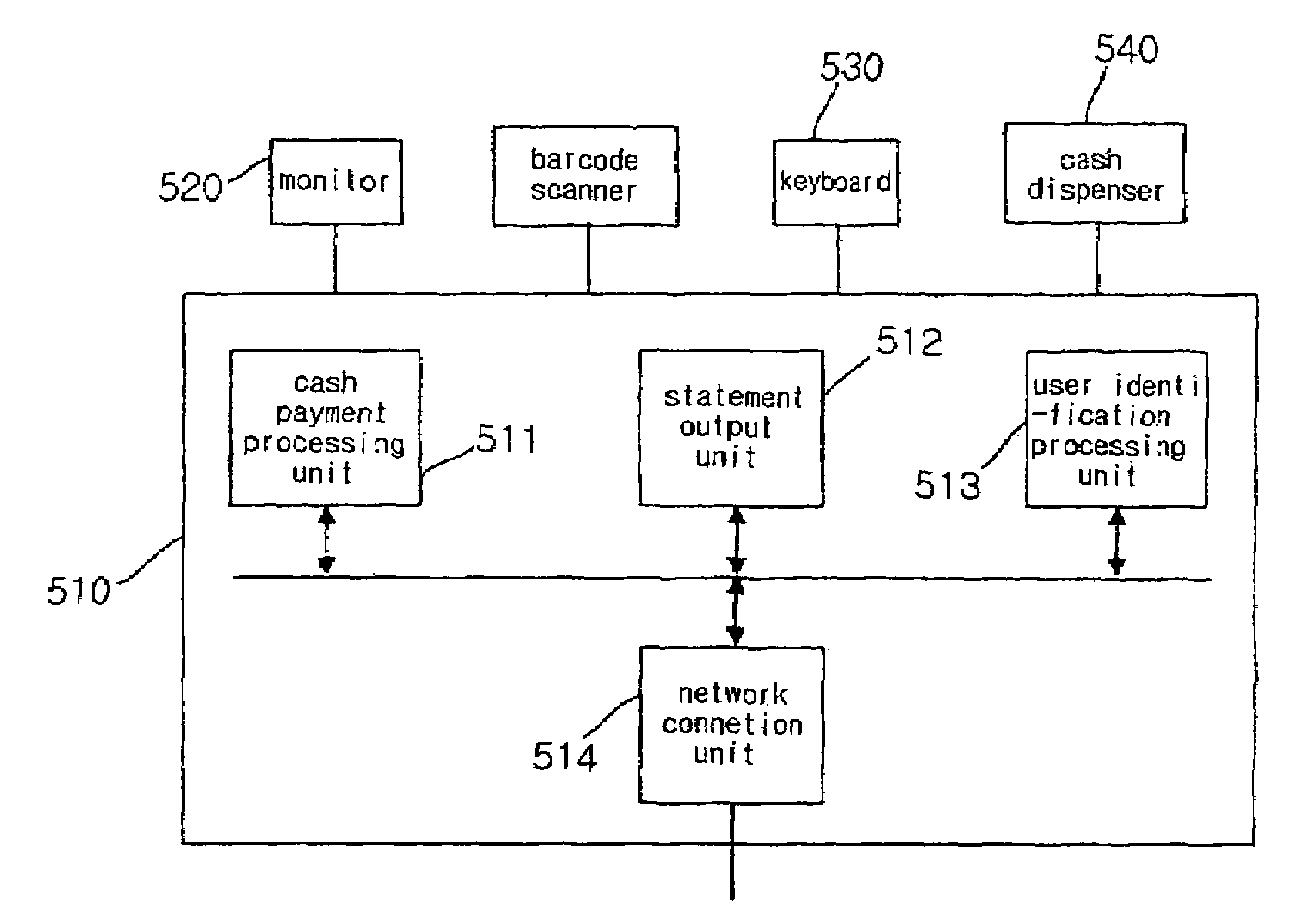

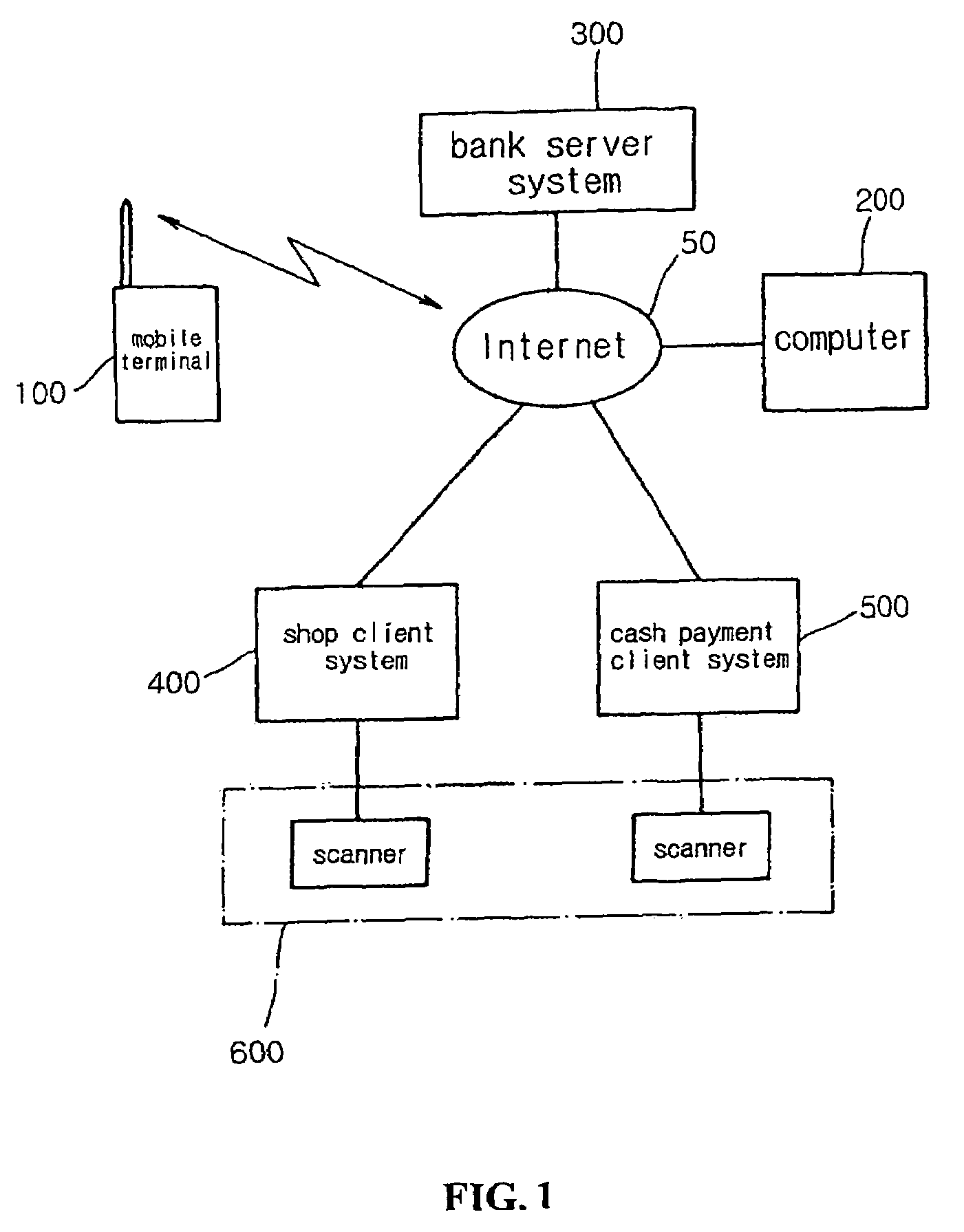

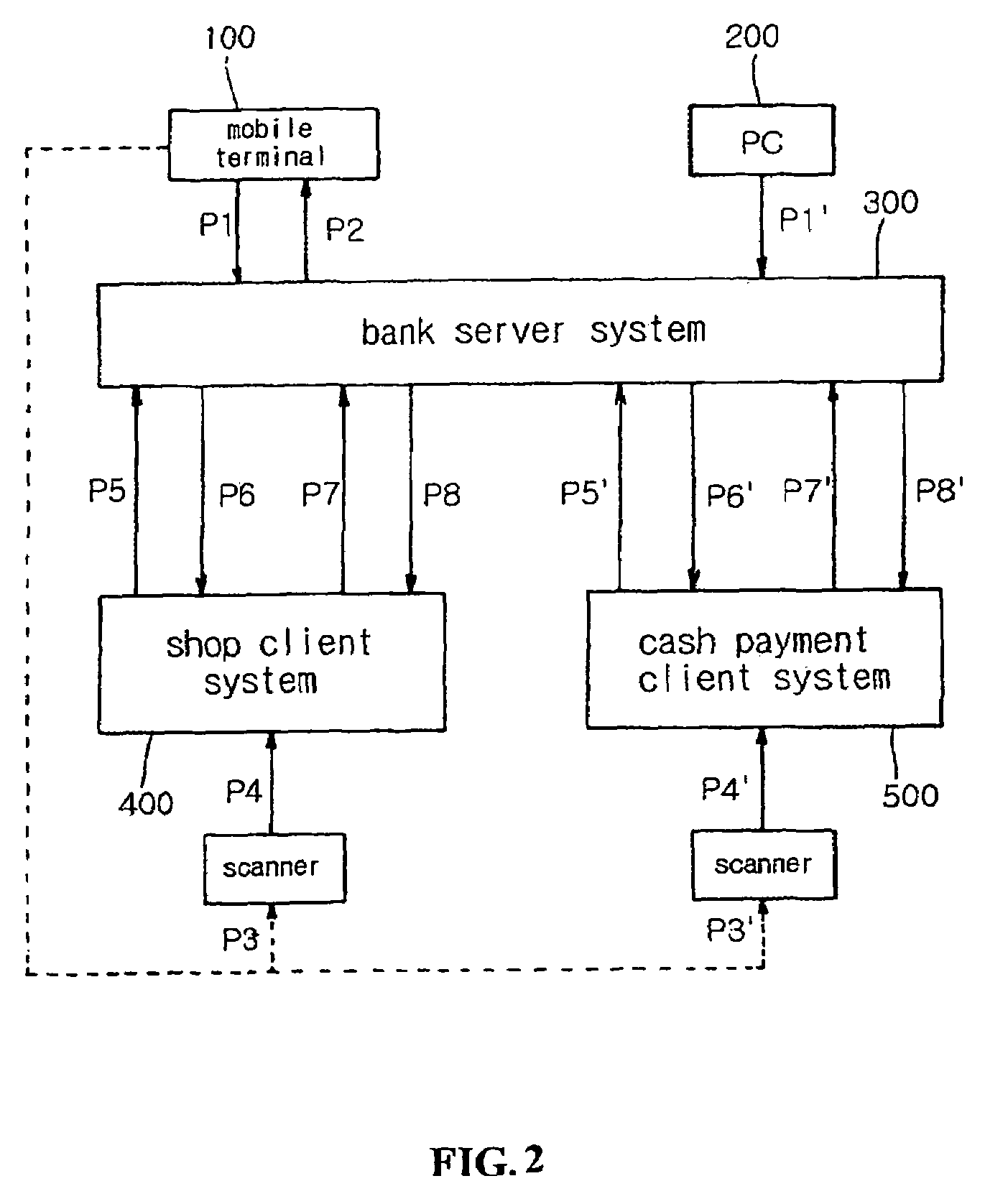

Electronic settlement system, electronic settlement method and cash paying method using LCD barcode displayed on mobile terminal

Disclosed are an electronic settlement system, an electronic settlement method, and a cash payment method using a LCD barcode displayed on a mobile terminal, thereby simply performing member identification using the LCD barcode including member information, electronic settlement services (such as credit card settlement, direct payment card settlement, advance payment card settlement, small amount settlement, and Giro system settlement) at various shops via a procedure verifying whether a user is an actual owner of the barcode, cash payment services via member information barcode and member identification procedures, advance payment card services by depositing a designated amount of money at a database of the bank and allowing the user to systematically use the advance card within the deposited money, and wireless banking services for transmitting and receiving various banking related data via wireless network between the bank and the members.

Owner:SECUBAY CORP +1

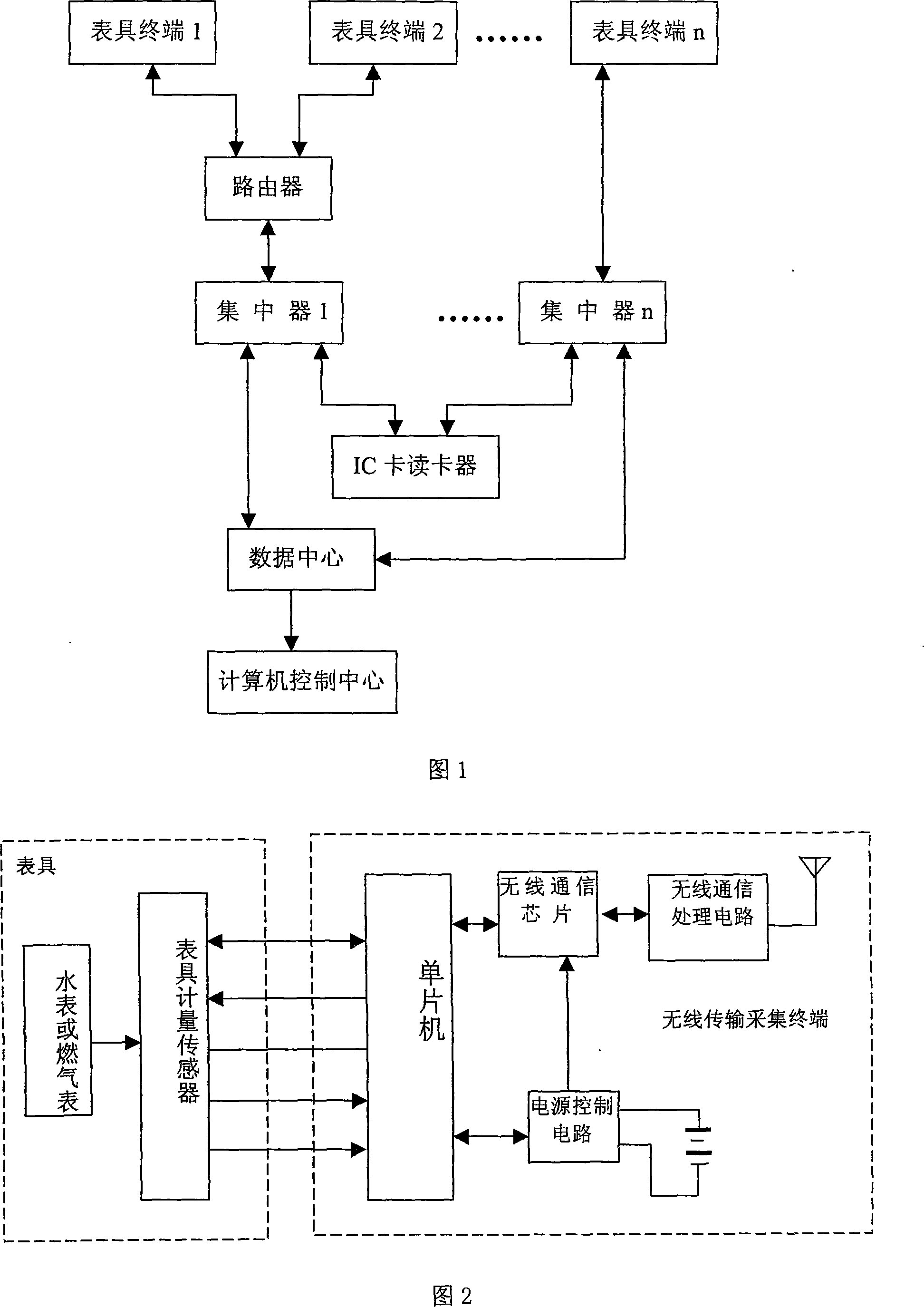

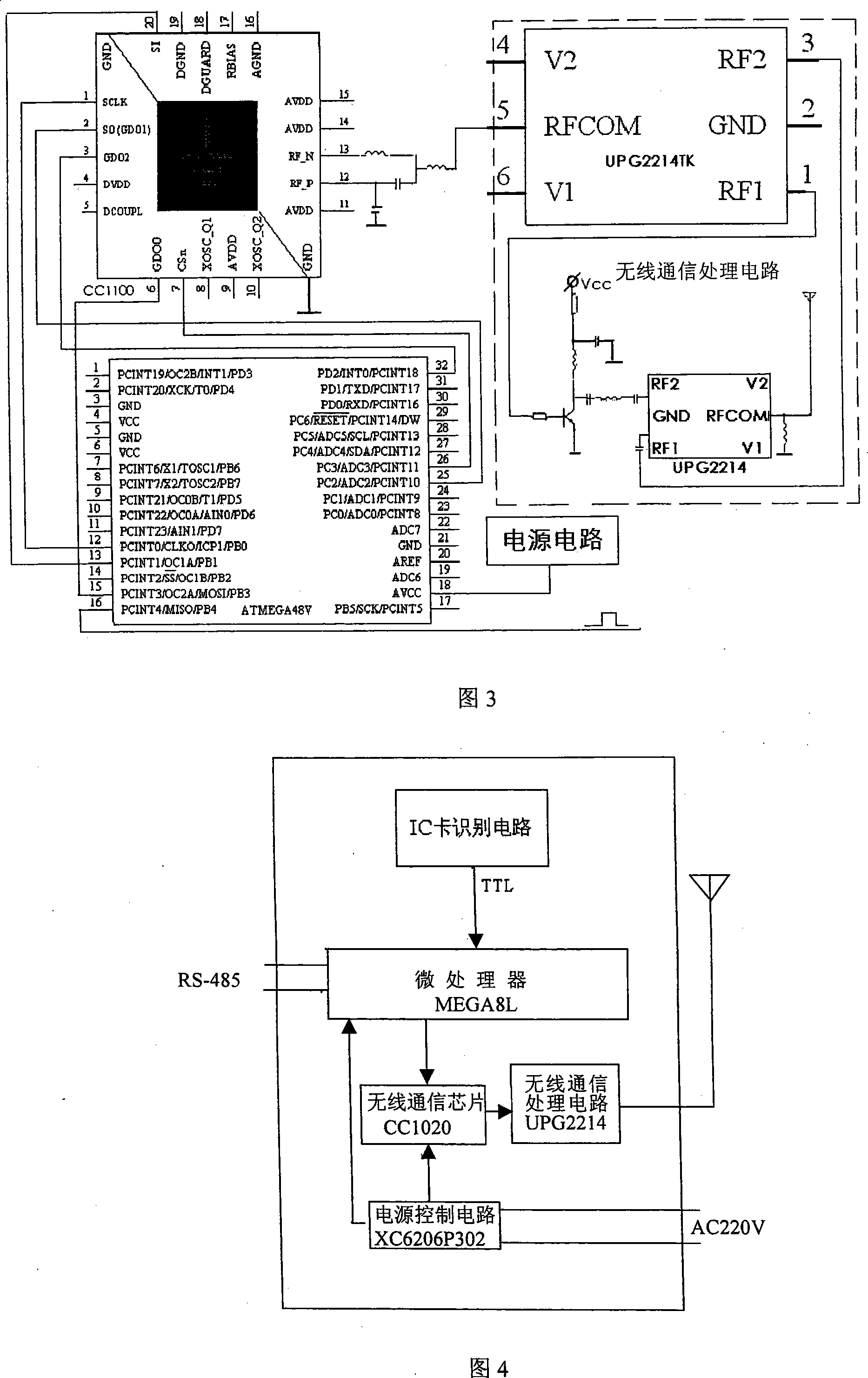

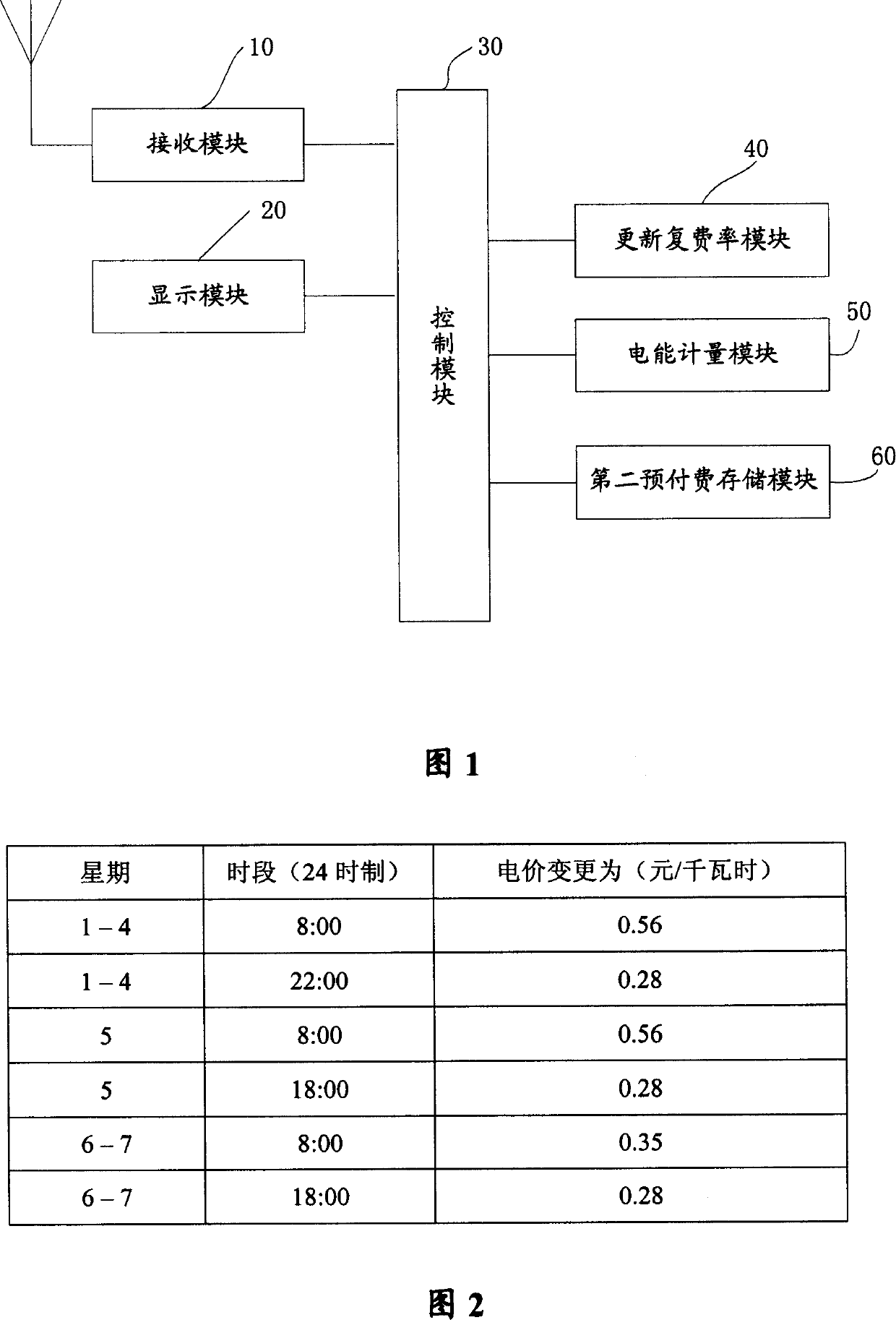

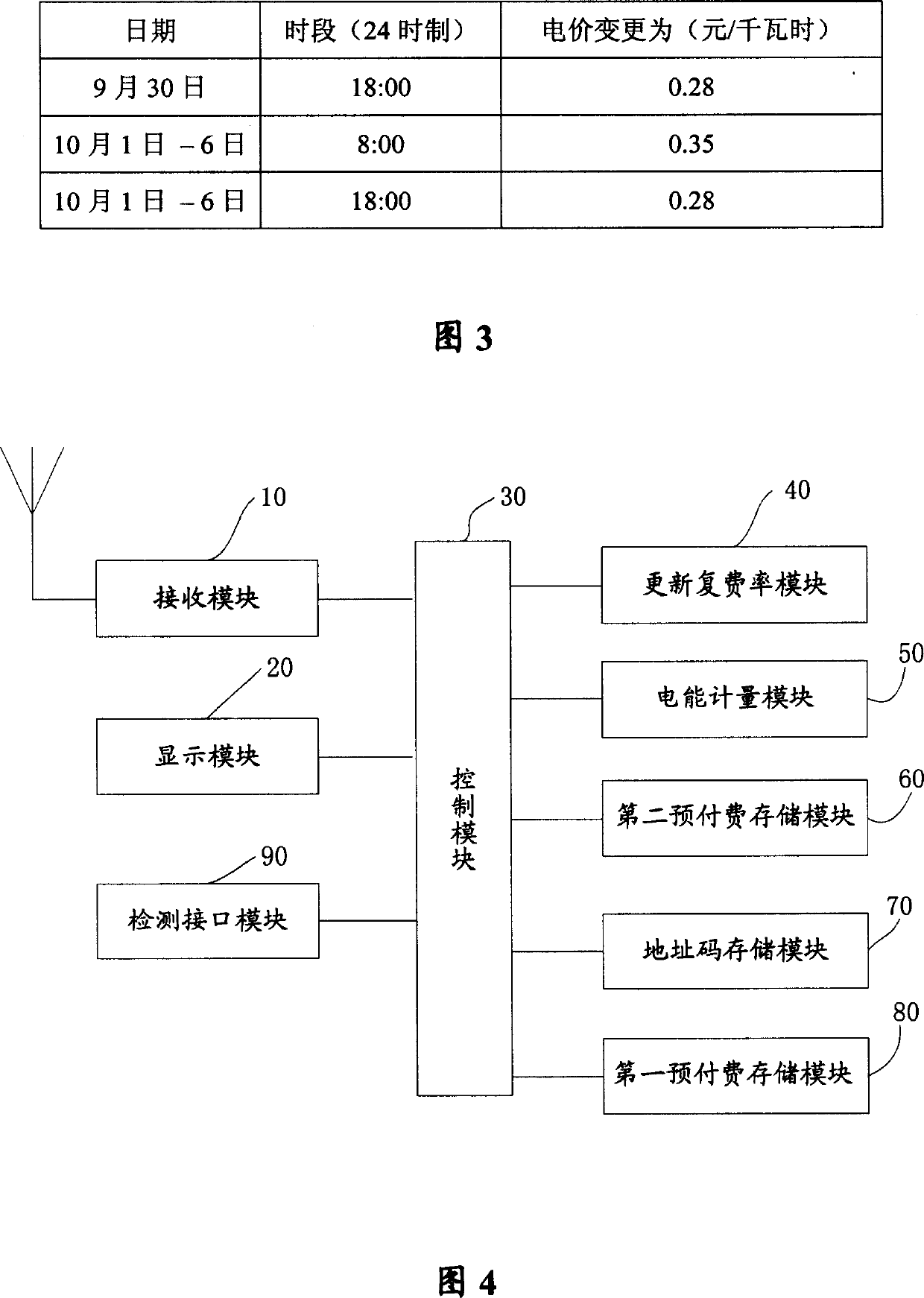

Pre-payment bidirectional real time valve controlling wireless meter reading method and system thereof

ActiveCN101159090AEliminate the difficulty of chargingAvoid the disadvantages of installing a card readerTransmission systemsPaymentData center

The invention relates to a prepayment two-way real-time control valve wireless meter reading method and the system thereof. The system is that a meter set terminal consisting of the meter set and a wireless collection terminal is wirelessly connected with a concentrator. The concentrator is wirelessly connected with the computer control center through the data center. An IC card reader is connected with the concentrator. With the method of IC card recharging, the invention prepays to buy use level value, which changes the business model of payment before use and solves the problem of difficult charging of the prior wireless far transfer meter reading.

Owner:LIAONING MINSEN METER

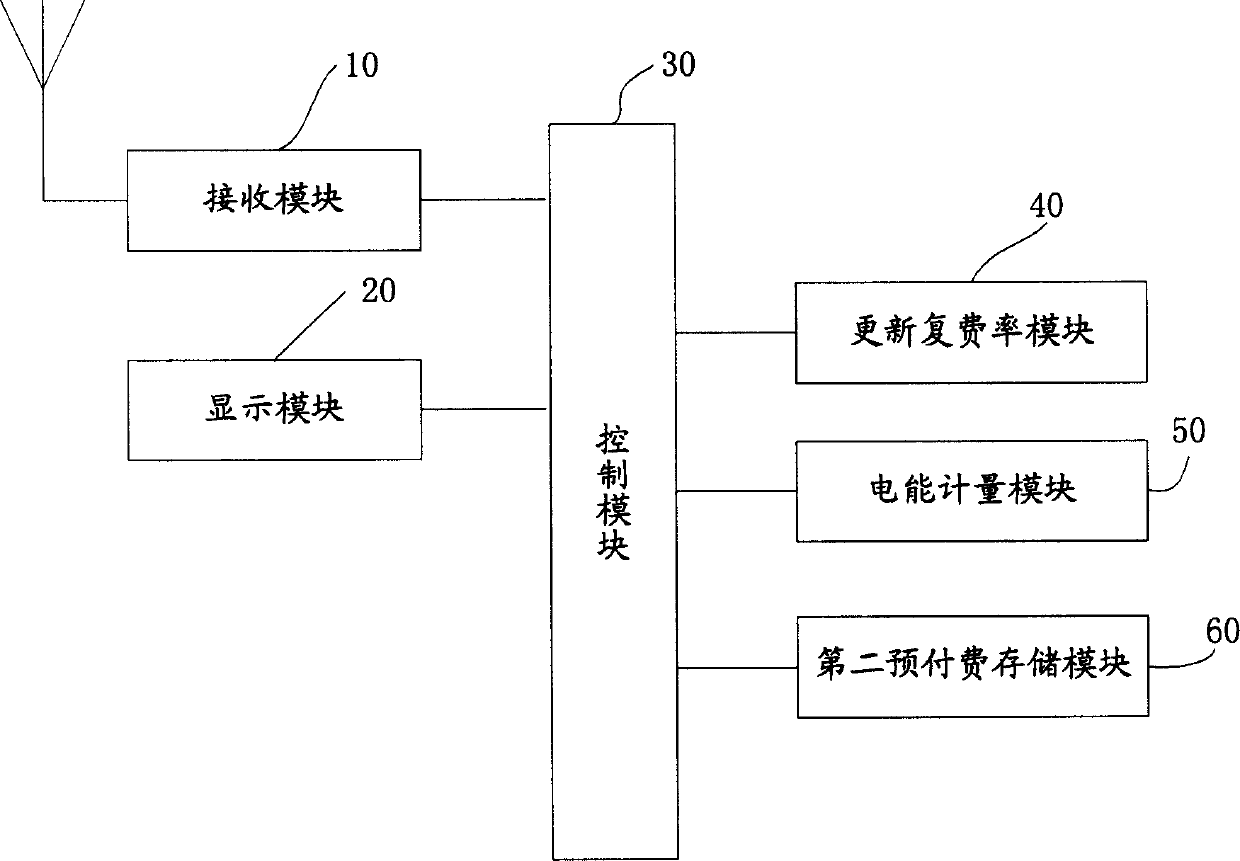

Wattmeter

InactiveCN1540358AEasy to manageAccurate timingTransmission systemsSpecial tariff metersWattmeterElectric power

The wattmeter includes following modules: reception module for receiving signals from electric power administration center in real time, including rate for current period; control module connected to the said reception module; rate update module of storing and updating current rate, and updating the rate based on command from connected control module; electric power measure module connected to control module for metering power consumption of each user's unit, energy charge is calculated from power consumption in unit period and rate for each time period. It is not needed for setting up a clock to find out rate for corresponding time period, and easy to correct improper operation of advance payment.

Owner:段翔 +2

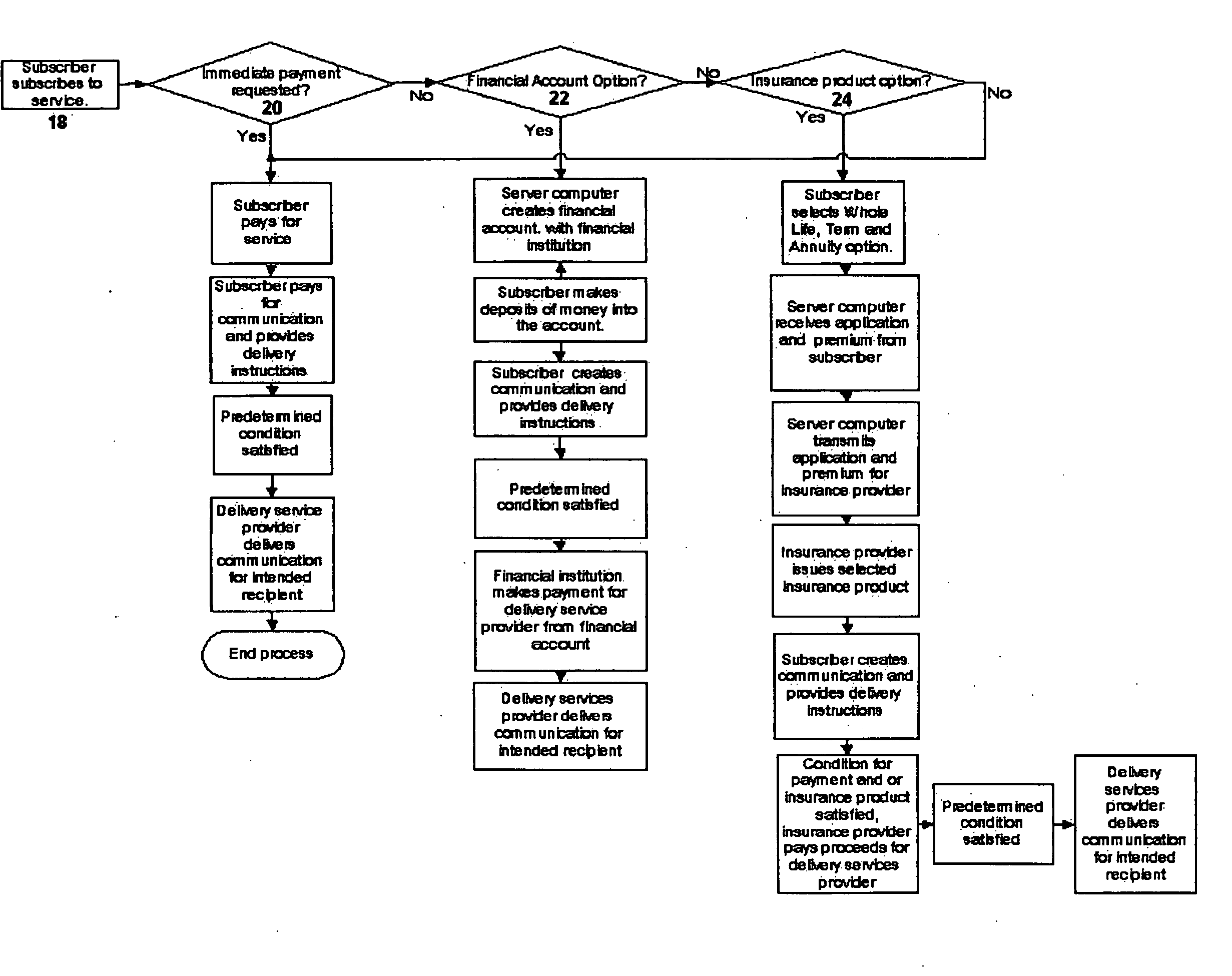

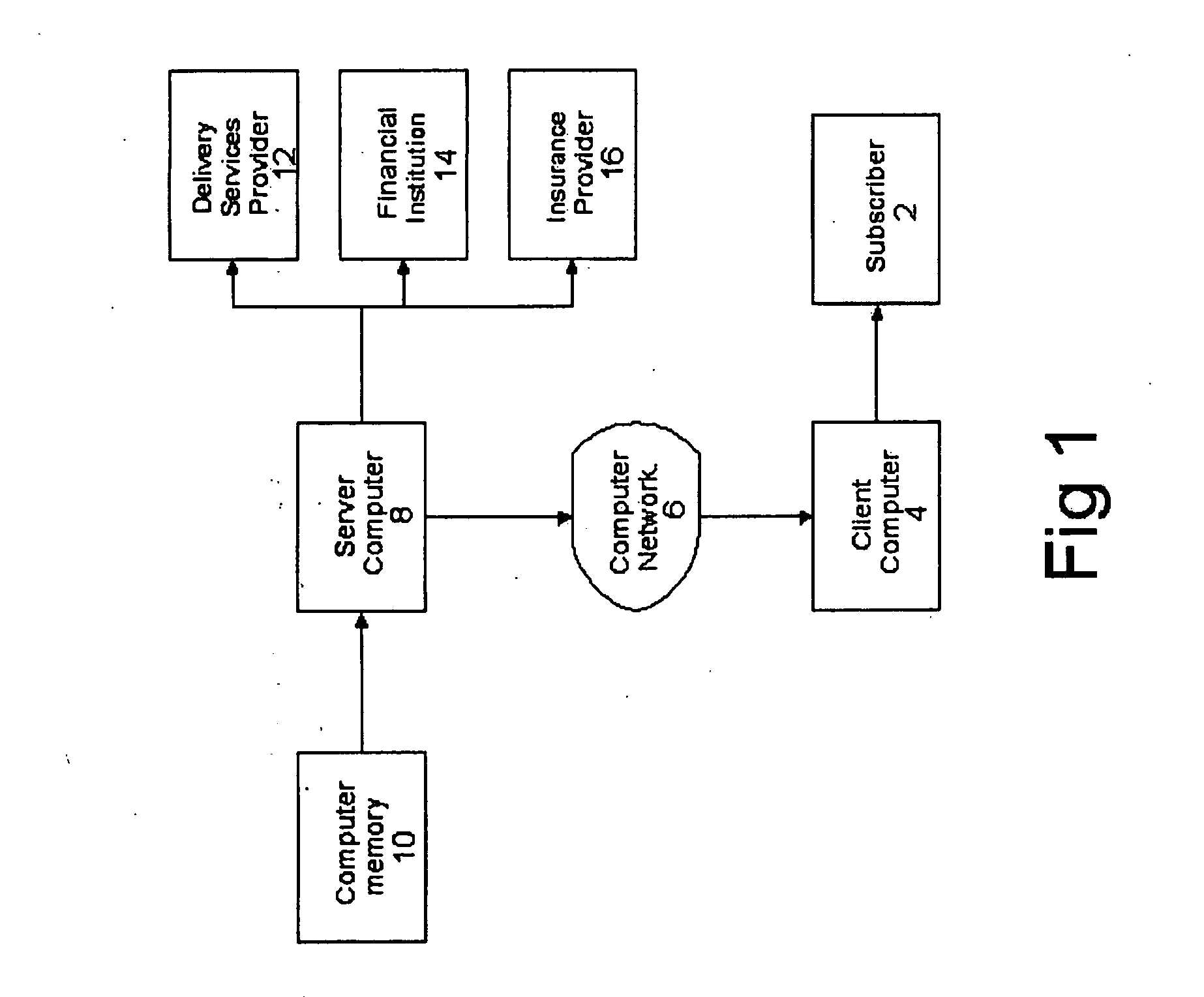

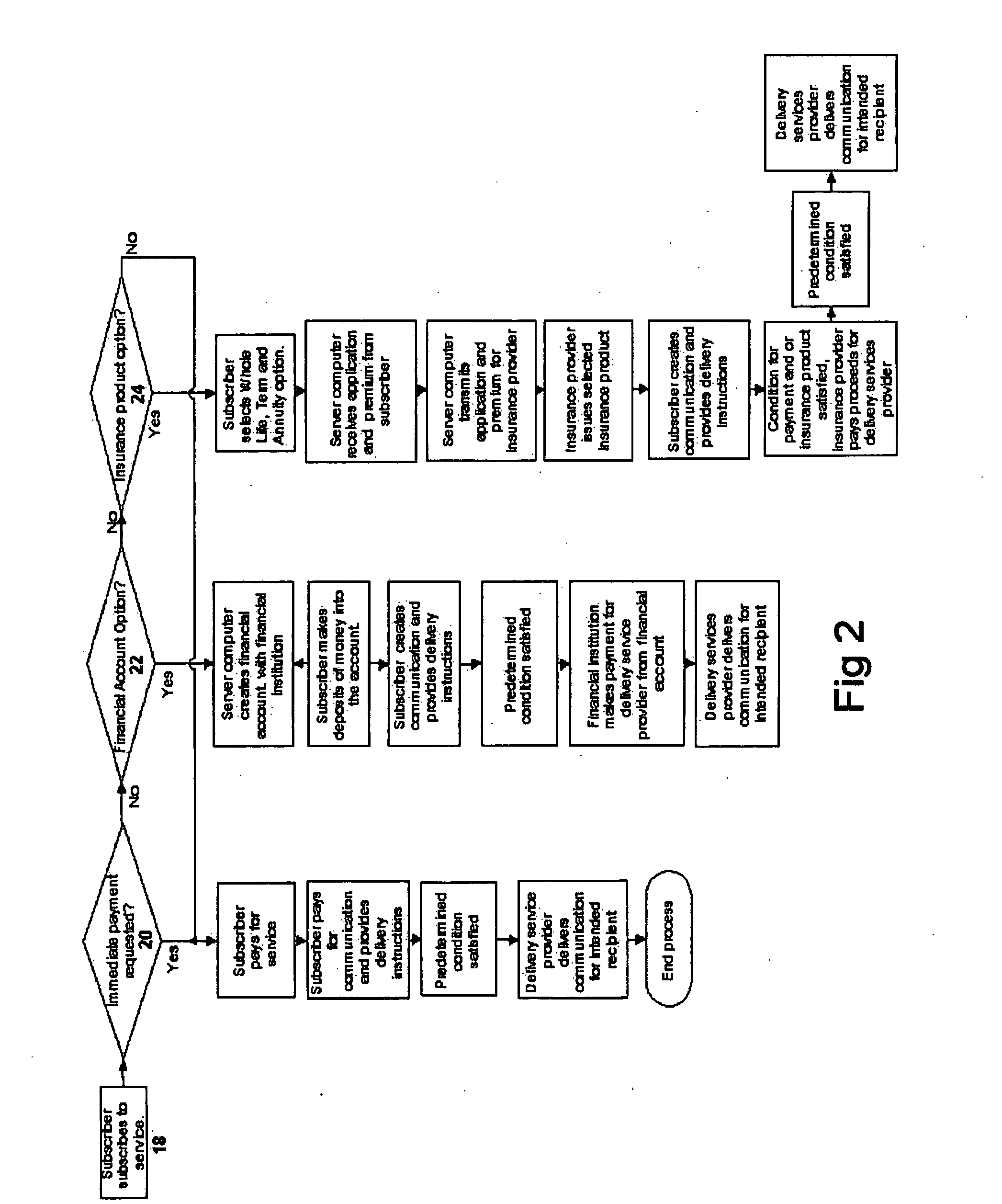

Future delivery apparatus and method

InactiveUS20070061471A1Maximum flexibilityMultiple digital computer combinationsLogisticsComputer networkDeposit account

The Invention is an apparatus and method for delivering communications to an intended recipient upon the occurrence of a predetermined condition in the future. A subscriber subscribes on-line with a delivery services provider. The subscriber creates or orders a communication, which may include a good or service. Upon the occurrence of the predetermined condition, the delivery services provider locates the intended recipient and delivers the communication. For a written communication, the delivery services provider prints the communication and delivers the printed communication. The service is financed by an up front payment, by creation of a deposit account, or by purchase of a policy of insurance, all facilitated by the delivery services provider.

Owner:PRESERVING SENTIMENTS

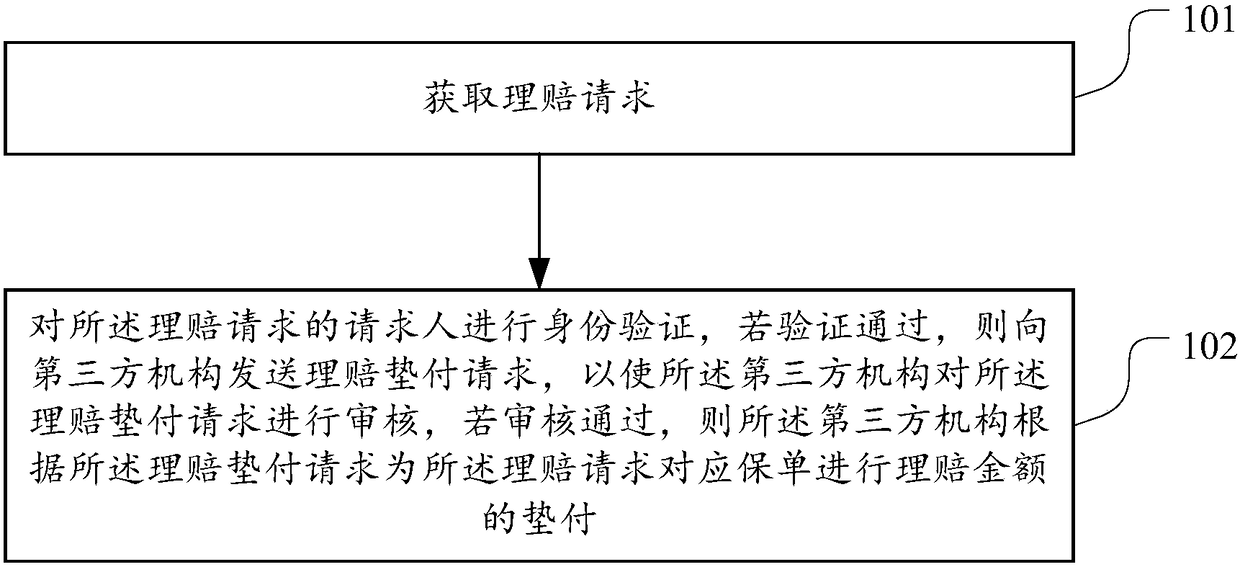

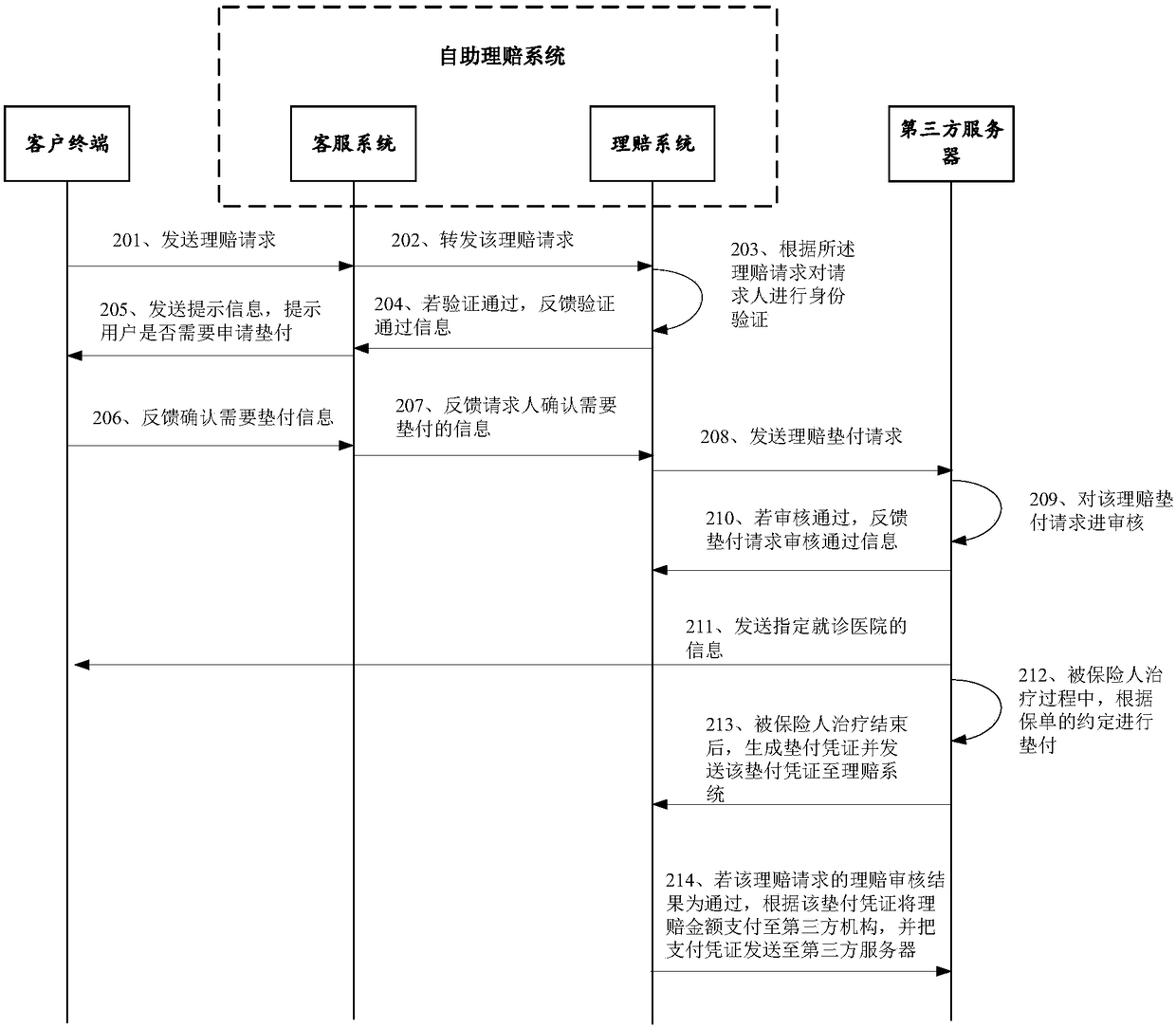

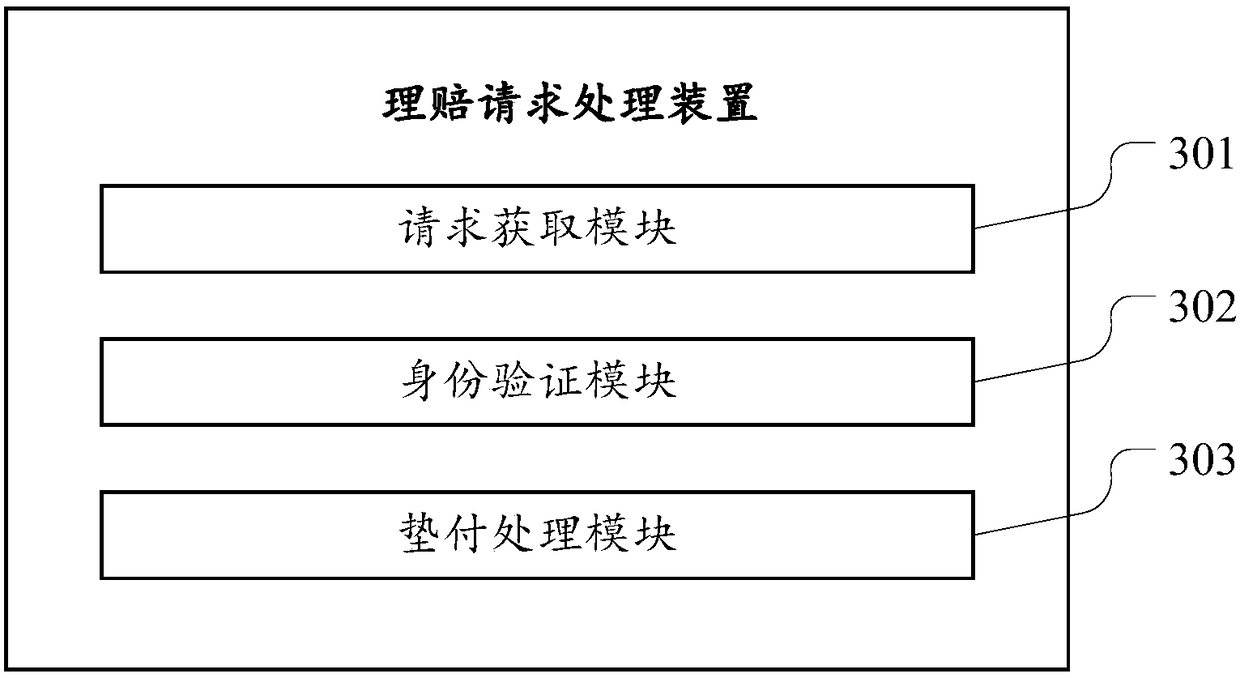

Claim settlement request processing method, device and system

InactiveCN108074183AImprove affordabilityImprove support capabilitiesFinanceThird partyComputer science

The invention discloses a claim settlement request processing method and aims to solve a problem of self payment in response to an insurance accident caused by incapability of obtaining the claim settlement sum instantly in the insurance claim settlement process. The method comprises steps that a claim settlement request is acquired; identity verification is carried out for a requestor of the claim settlement request, if verification passes, a claim settlement advance payment request is sent to a third-party mechanism to make the third-party mechanism audit the claim settlement advance paymentrequest, if audit passes, advance payment of the claim settlement sum is carried out by the third-party mechanism according to the claim settlement advance payment request for a declaration policy corresponding to the claim settlement request. The invention further provides a claim settlement request processing device and system.

Owner:PING AN TECH (SHENZHEN) CO LTD

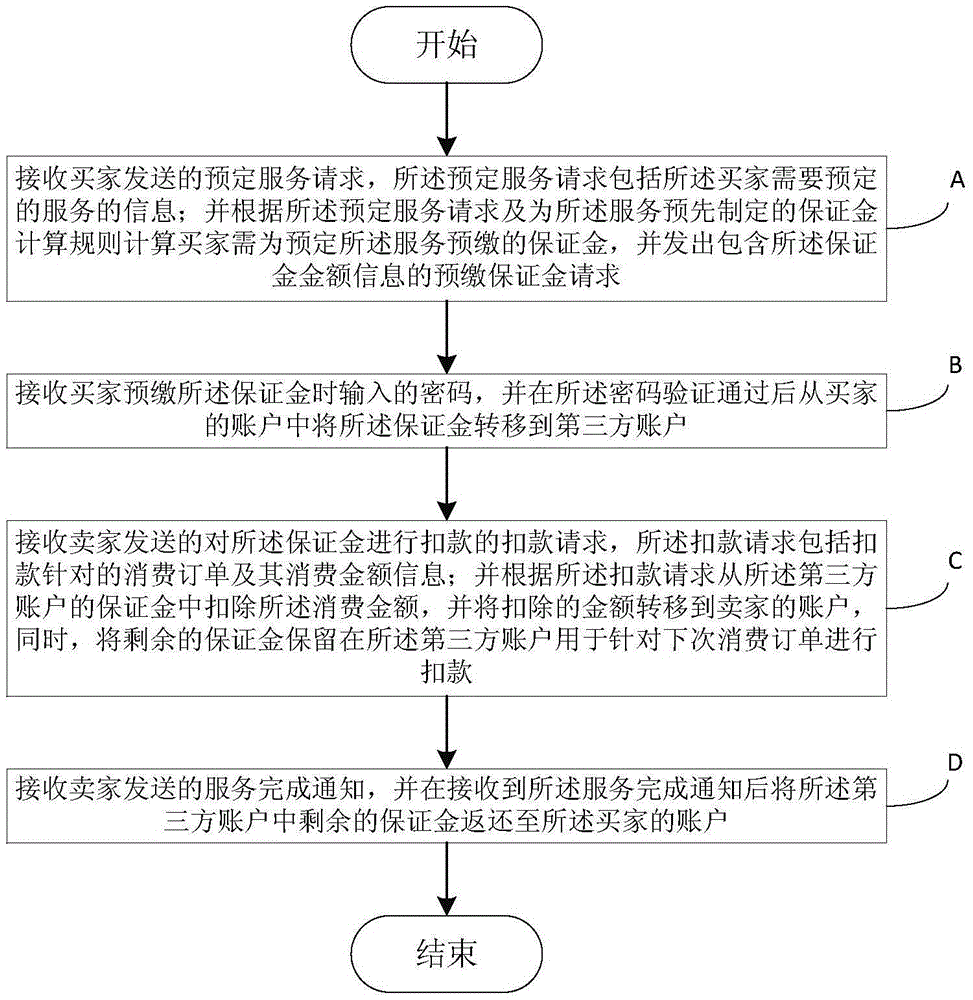

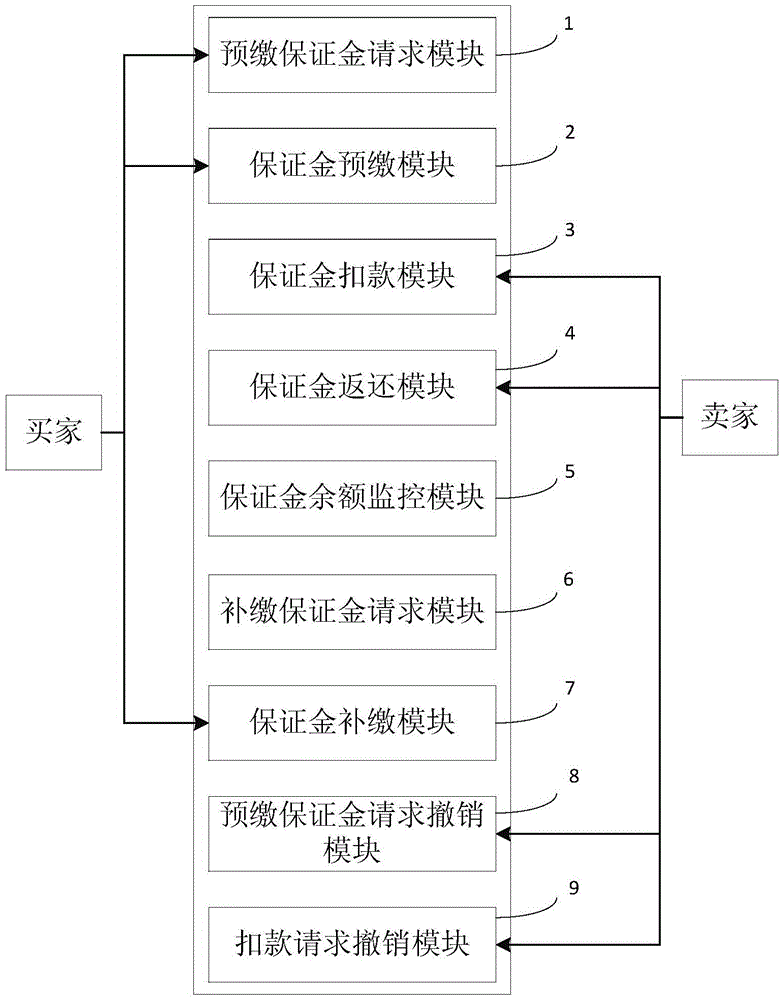

Cash deposit based trading method and system

InactiveCN105550865AReduce cash flow pressureReduce default riskCredit schemesComputer scienceAdvance payment

The invention relates to the field of advance payment schemes, and particularly to a cash deposit based trading method and system. In the cash deposit based trading method and system provided by the invention, multi-time consumption can be carried out after cash deposit is prepaid for one time; and a buyer (consumer) can carry out multiple times of settlement based on needs of a seller. Due to the multiple times of settlement, a cash flow pressure of the seller can be lightened greatly; and meanwhile, a default risk of the buyer and loss of the seller caused by default of the buyer are reduced.

Owner:深圳市商连商用电子技术有限公司

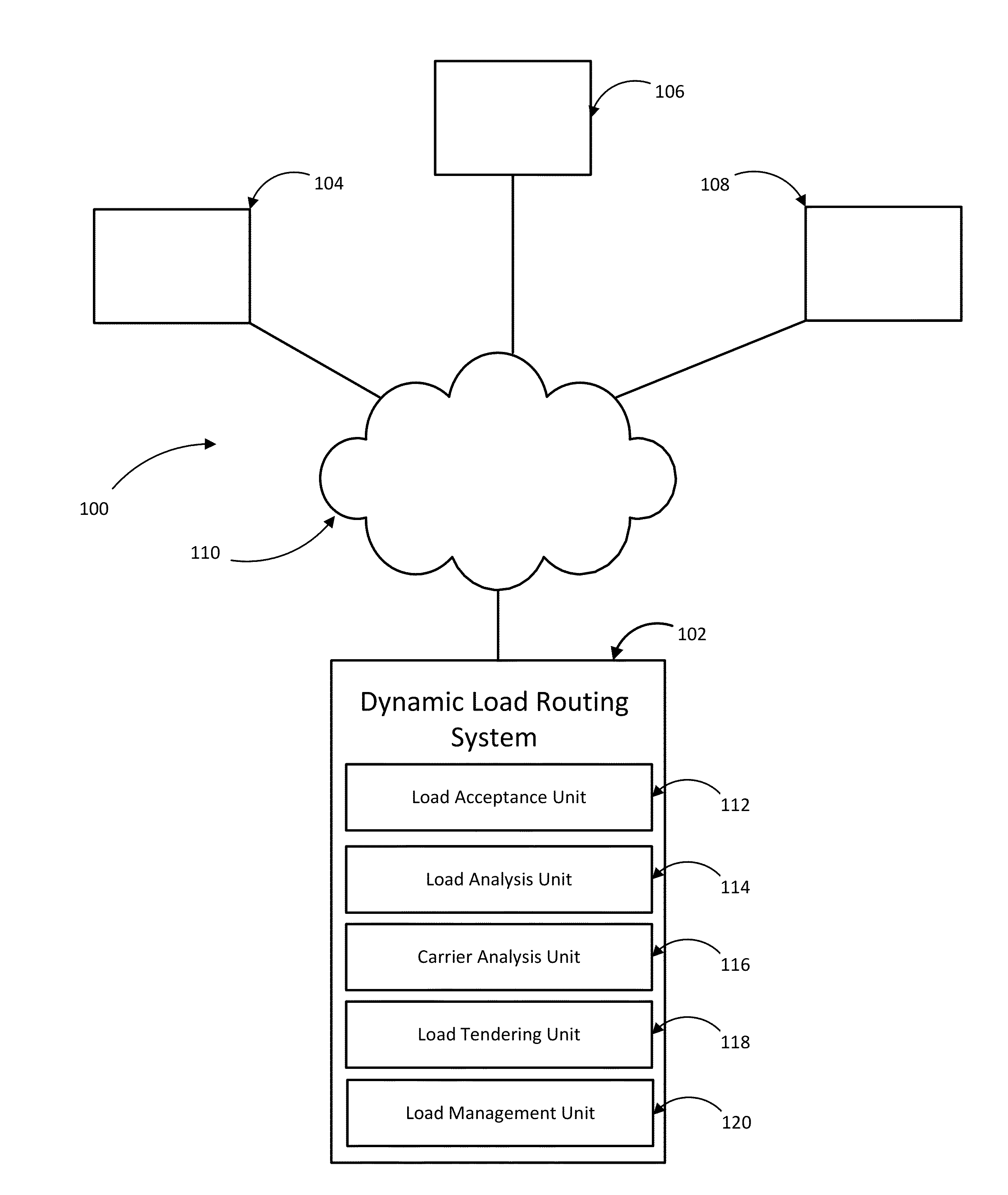

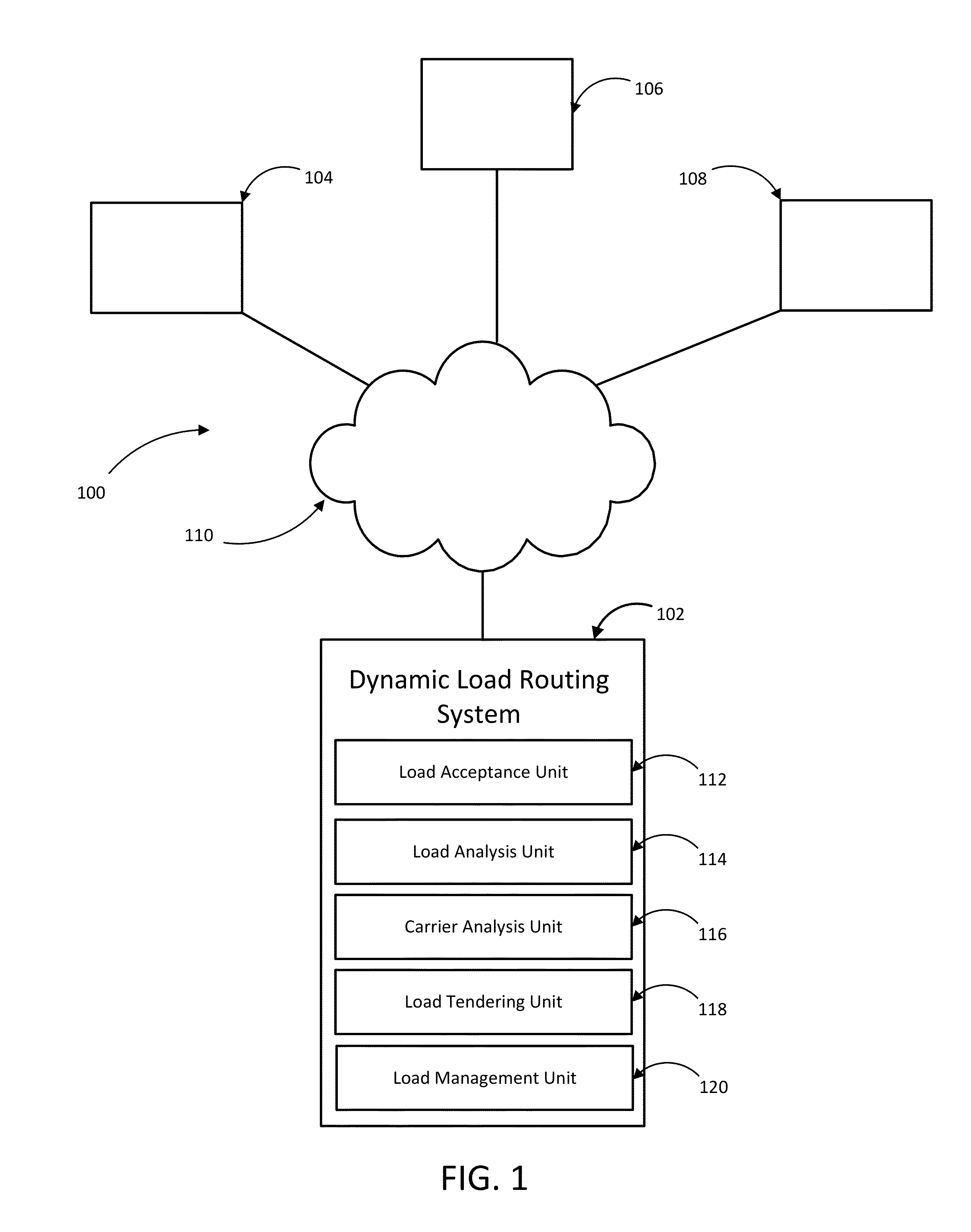

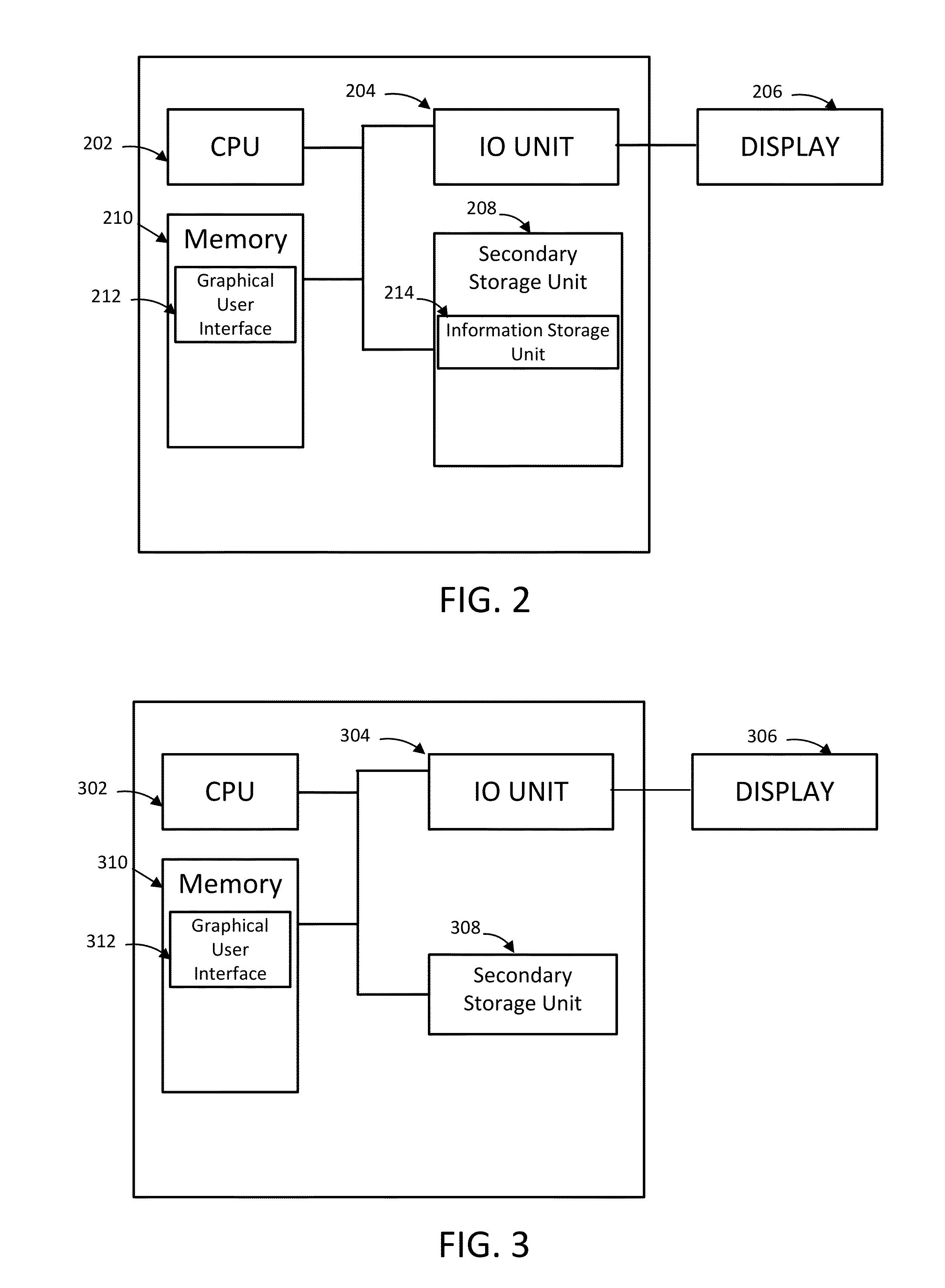

Logistics management system and methods of operating the same

An advance payment system having a processor, a memory and a load management unit performing the steps of receiving a request for an advanced payment for a load from a carrier, receiving information from the carrier relating to the load, determining if the information satisfies the advanced payment rules for the load, generating an identification code if the information satisfies the advanced payment rules for the load, assigning an expiration time to the identification code, and disabling the identification code when the expiration time has elapsed.

Owner:COYOTE LOGISTICS

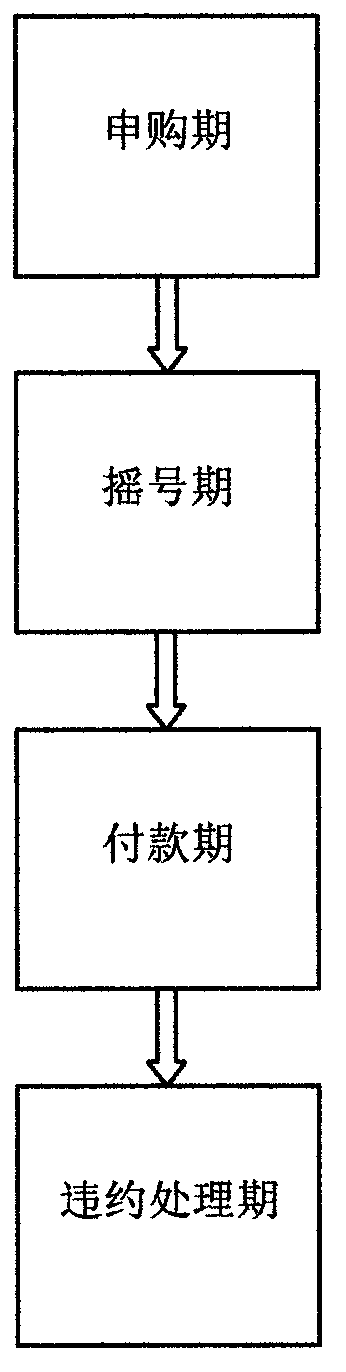

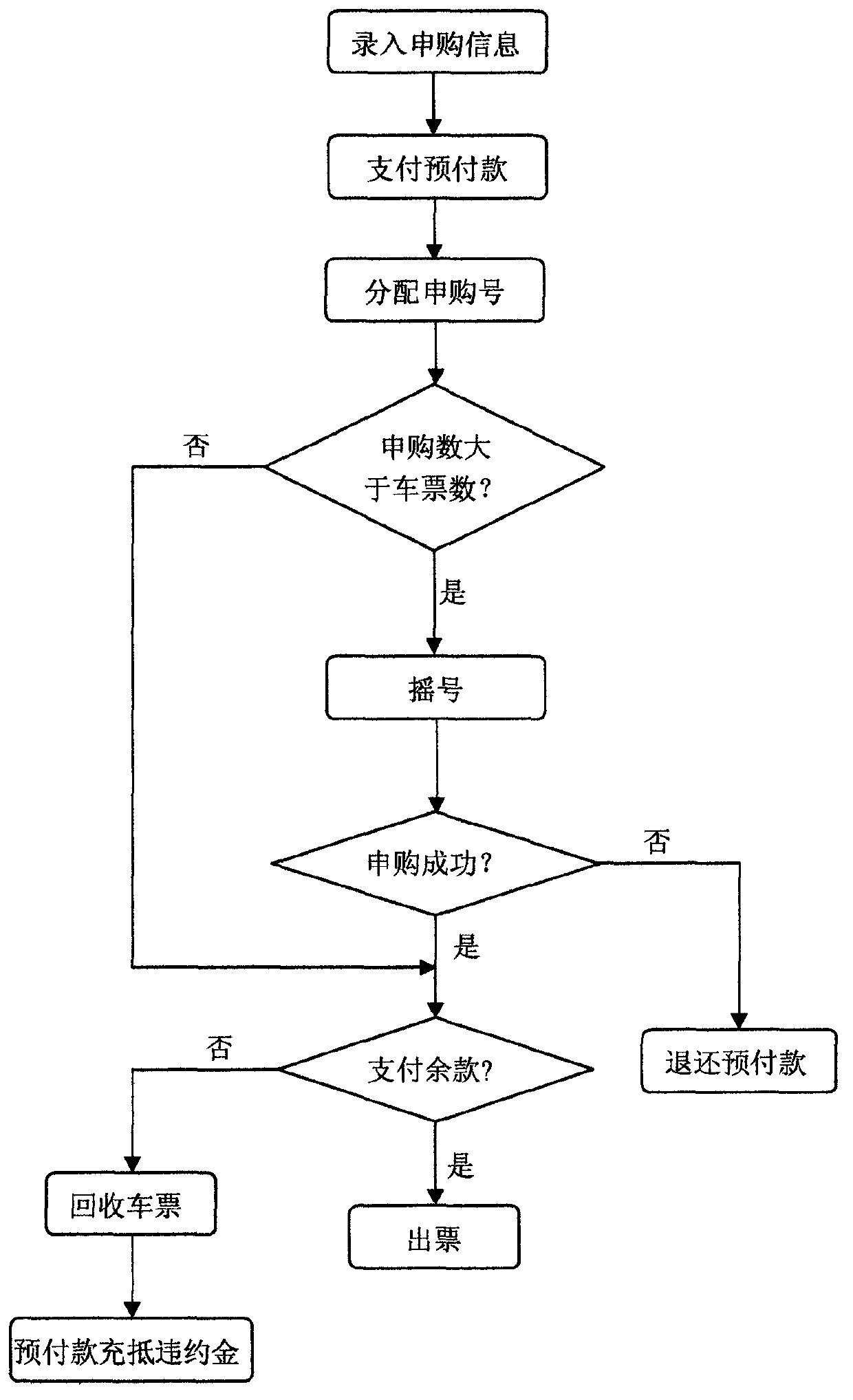

Train ticket network sale method

InactiveCN103745387APut an end to ticket grabbing and sellingMarketingComputer scienceTreatment period

The invention discloses a train ticket network sale method, which is appropriate for core business logic processing of a network ticket sale information system, can completely eradicate ticket hoarding behavior of ticket brokers during the Spring Festival travel, and ensures the fairness of ticket booking for passengers. The method divides a ticket booking process into four time periods: a subscription period, a lottery period, a payment period and a default treatment period. During the subscription period, the passengers input subscribing ticket information and pay advance payment, and a ticketing system distributes subscription numbers for the passengers. During the lottery period, if the number of the passengers for subscribing is less than ticket supply, one ticket is distributed for each person, and if the number of the passengers for subscribing exceeds the number of tickets, the tickets are distributed through a random lottery manner. During the payment period, the passengers who are distributed with the tickets pay the balance of the tickets, the ticketing system refund the advance payment to the passengers who are not distributed with the tickets, and the passengers can print the tickets after payment. During the default treatment period, the passengers who are distributed with the tickets but not pay the balance of the tickets are defaulted, the advance payment of the defaulted passengers is taken as default fine, and the ticketing system recycles the corresponding tickets.

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com