Patents

Literature

112 results about "Accounts payable" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Accounts payable (AP) is money owed by a business to its suppliers shown as a liability on a company's balance sheet. It is distinct from notes payable liabilities, which are debts created by formal legal instrument documents.

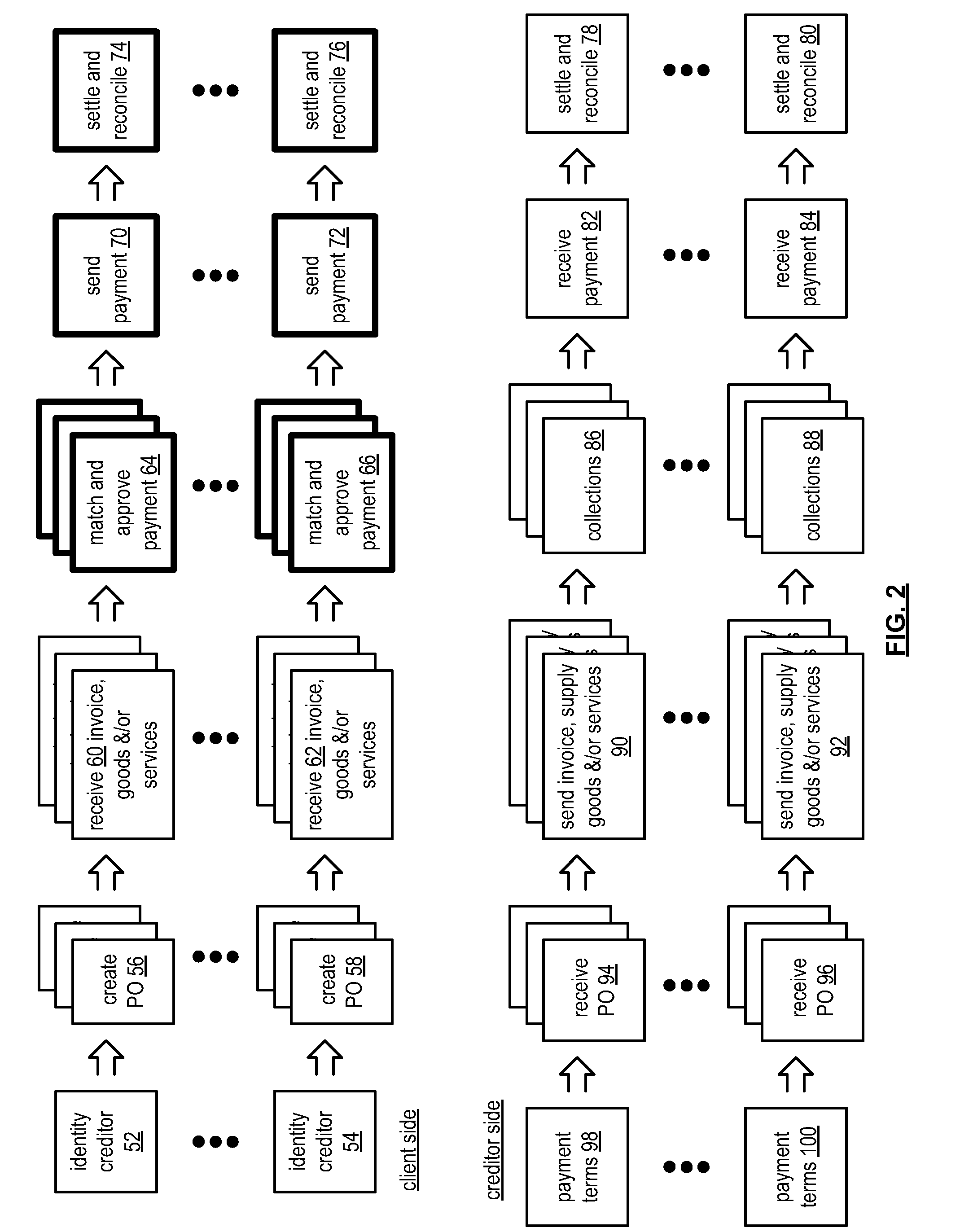

Electronic multiparty accounts receivable and accounts payable system

InactiveUS7206768B1Facilitating collection and trackingFacilitate communicationComplete banking machinesFinanceAccounts payableInvoice

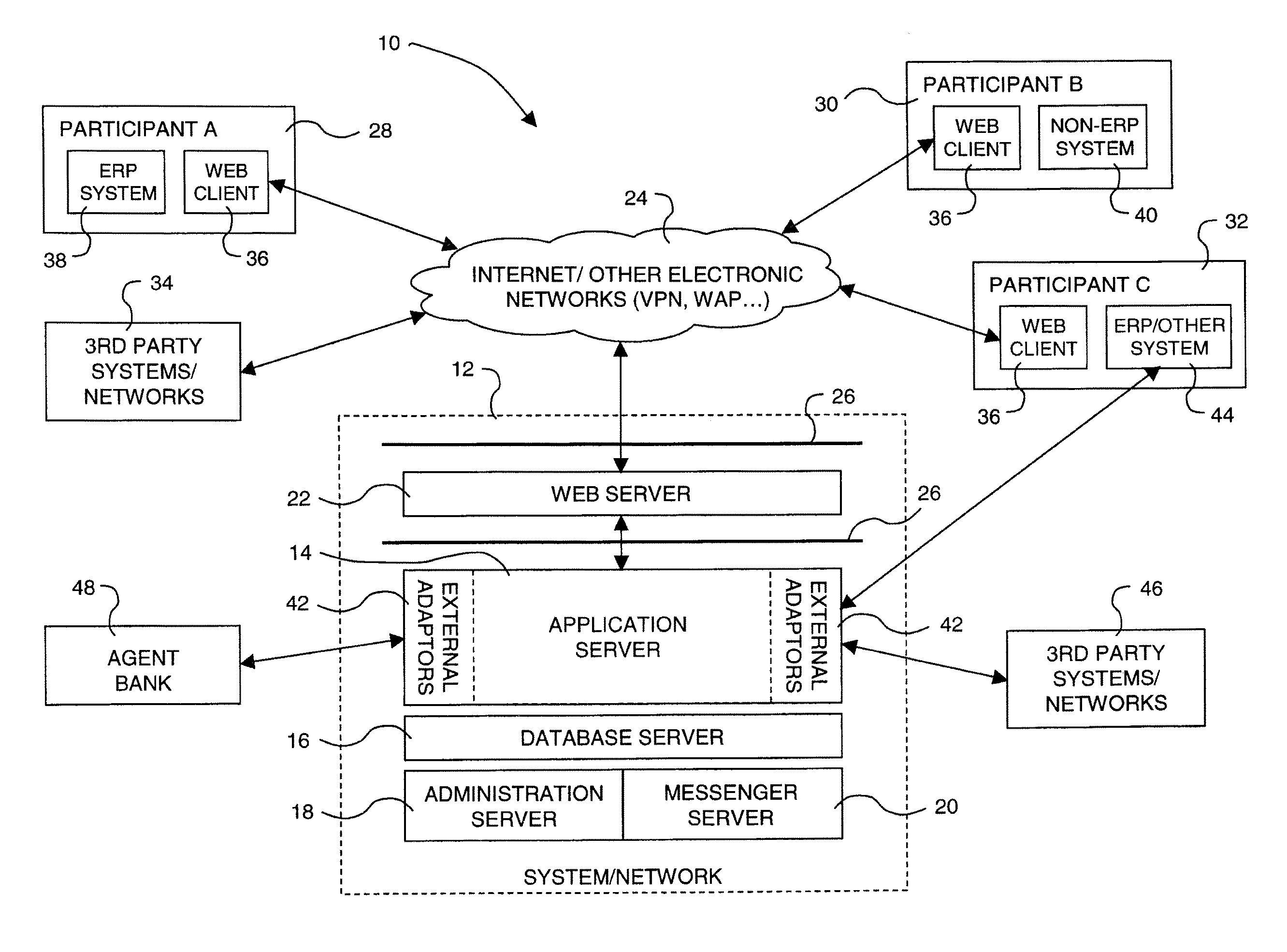

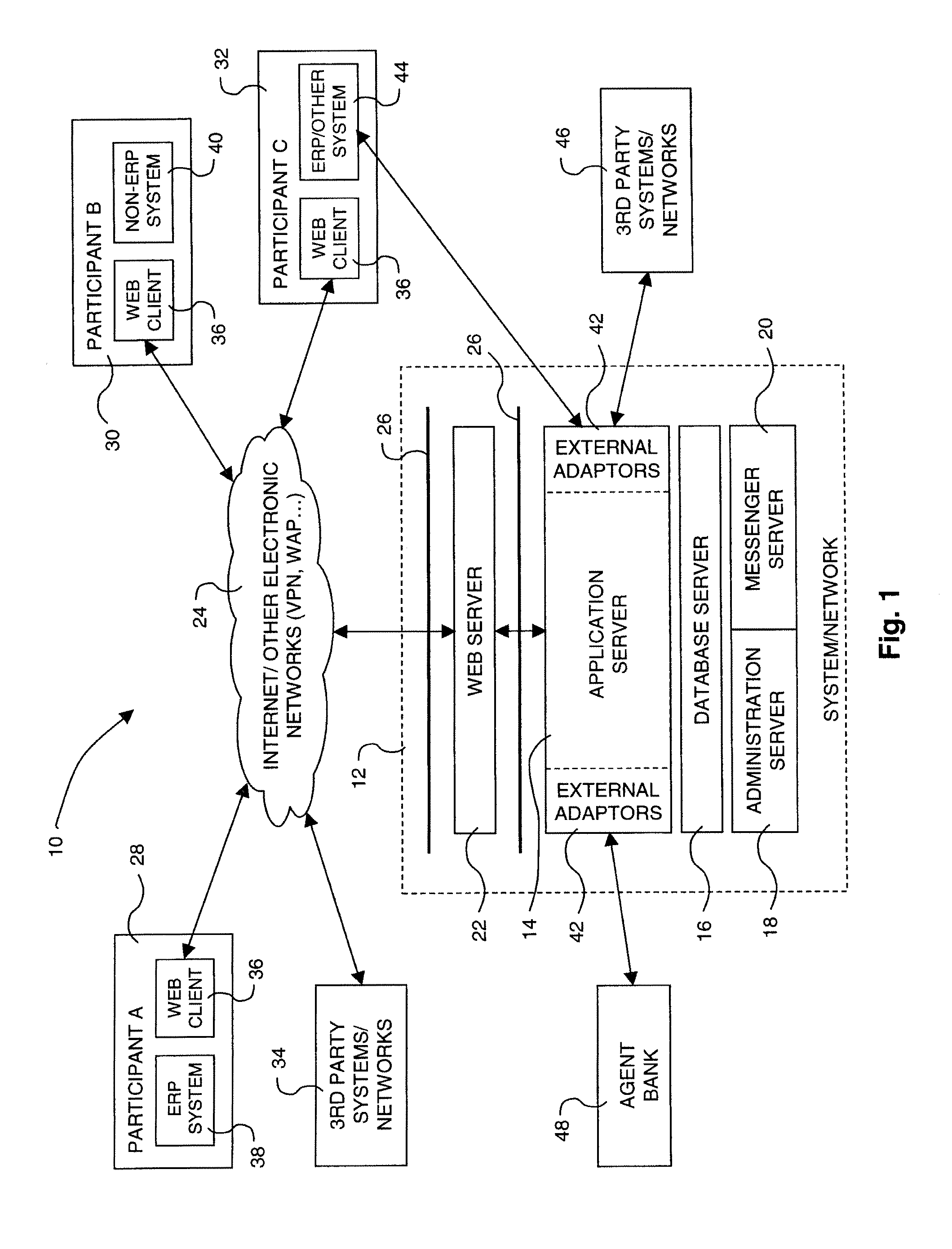

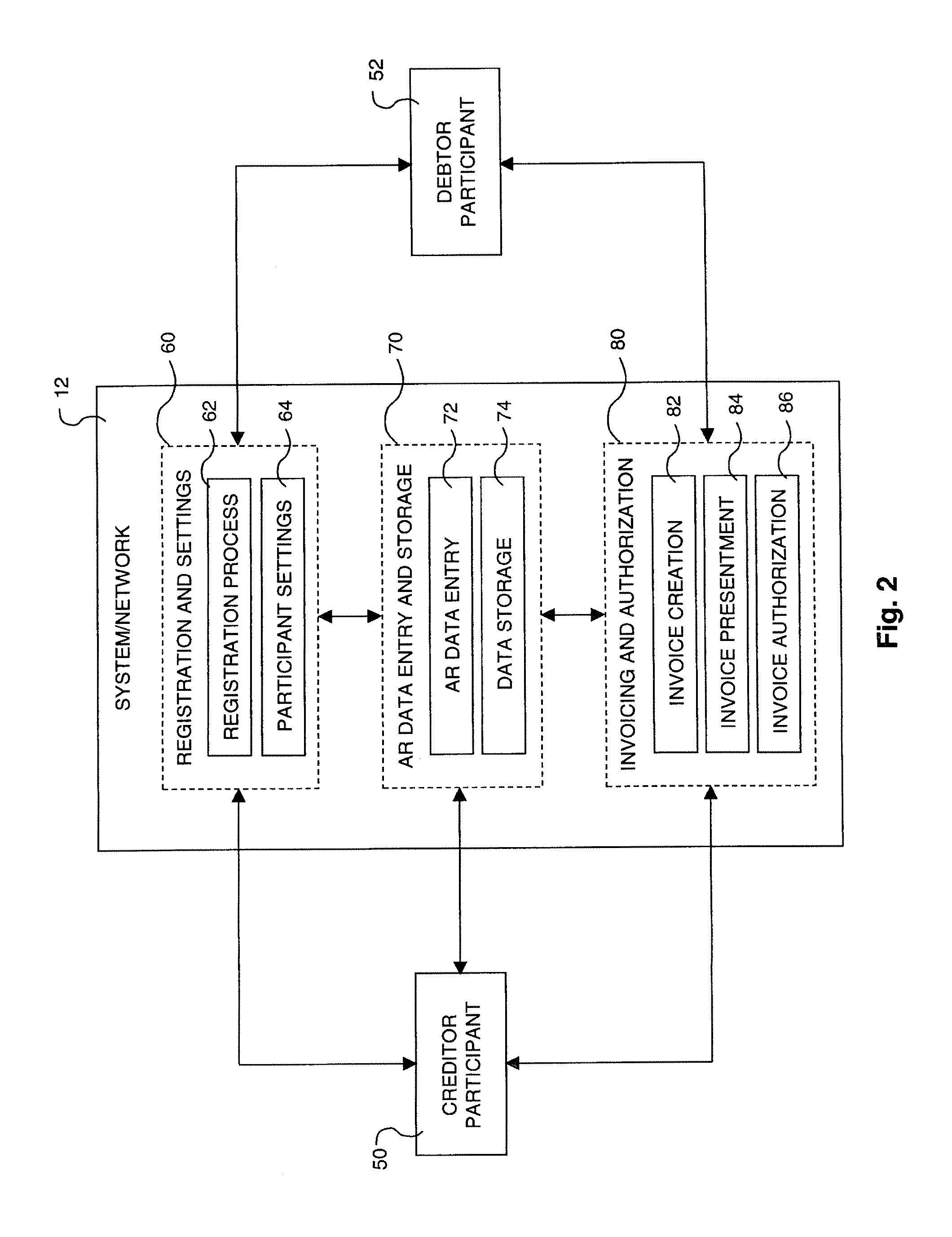

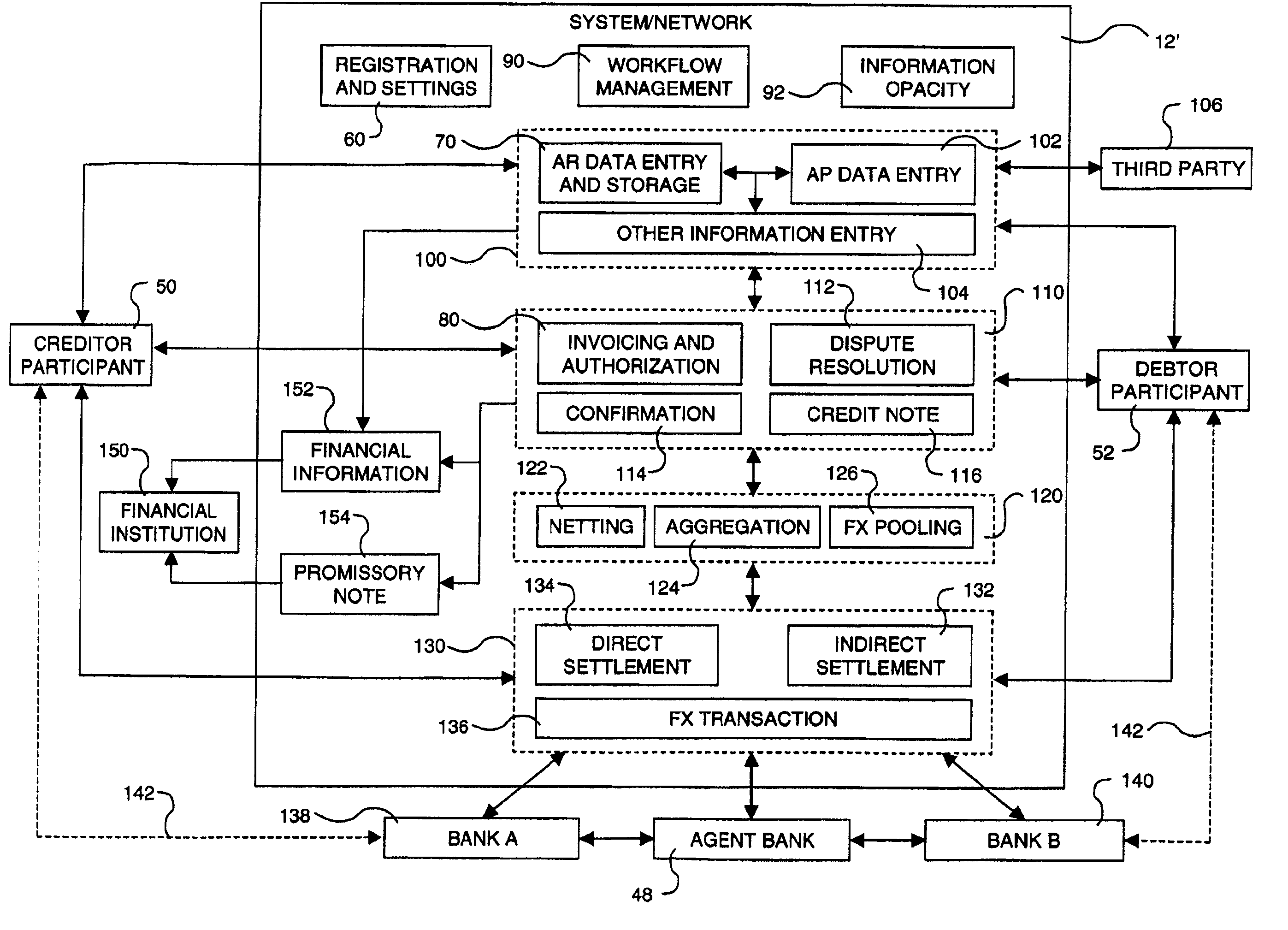

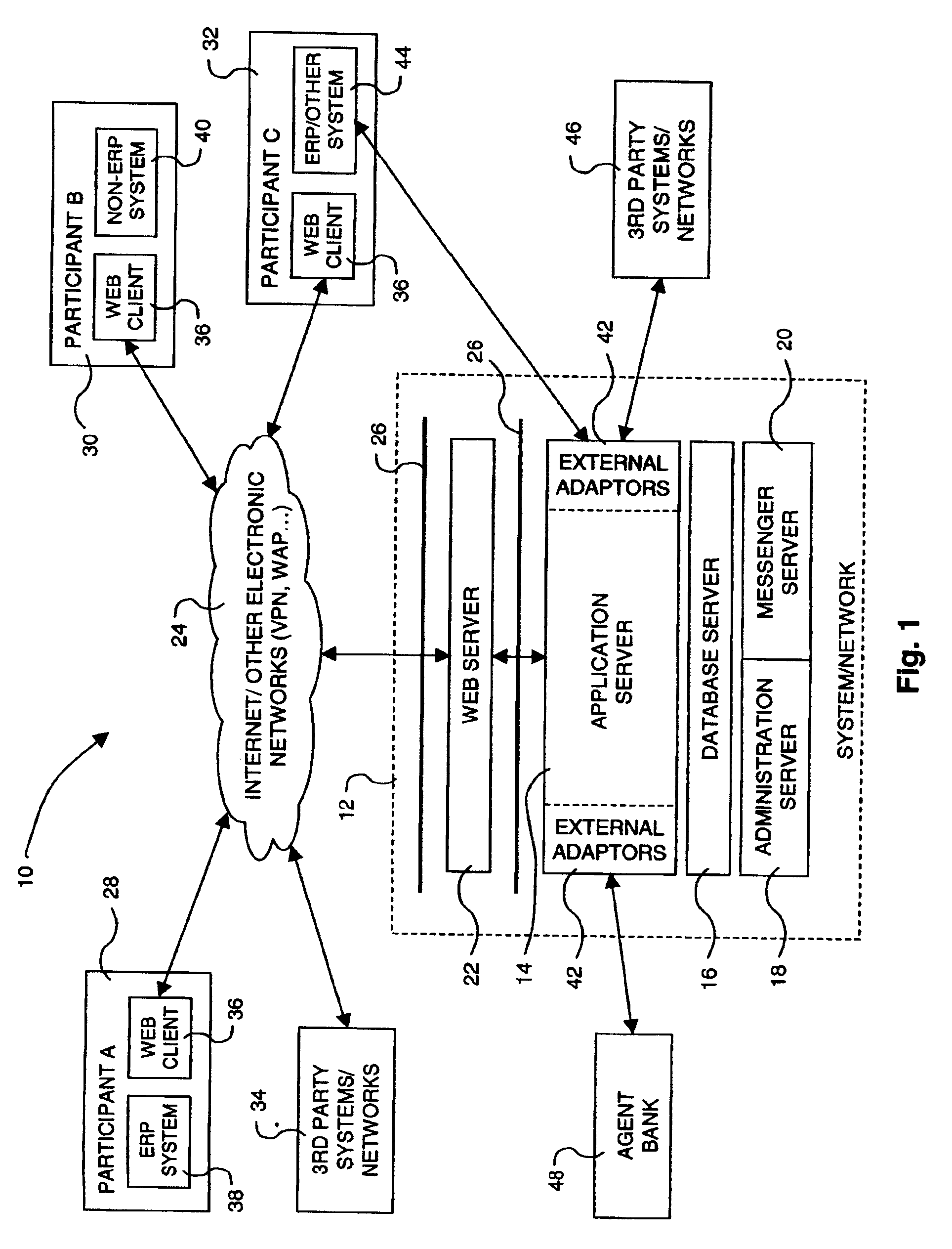

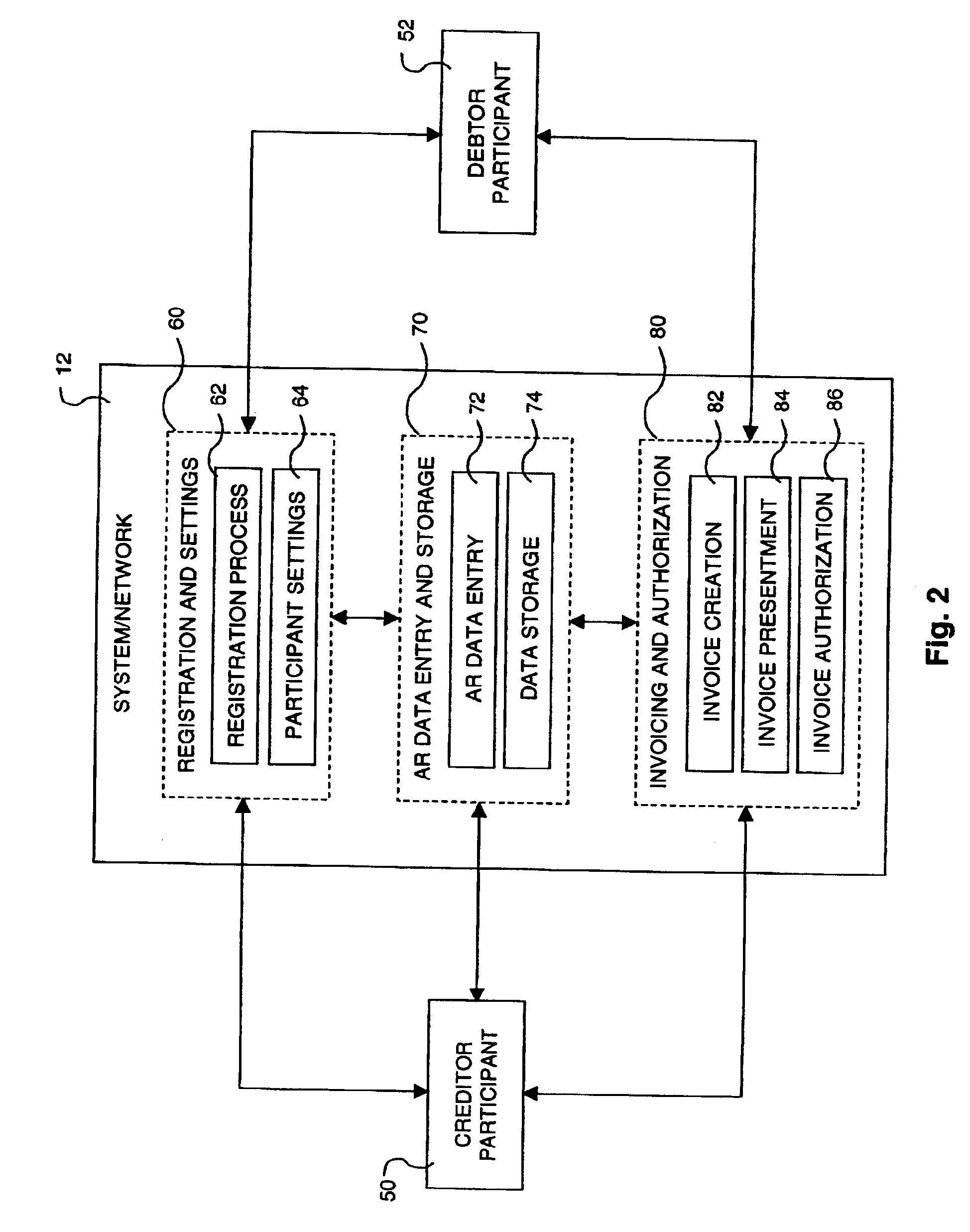

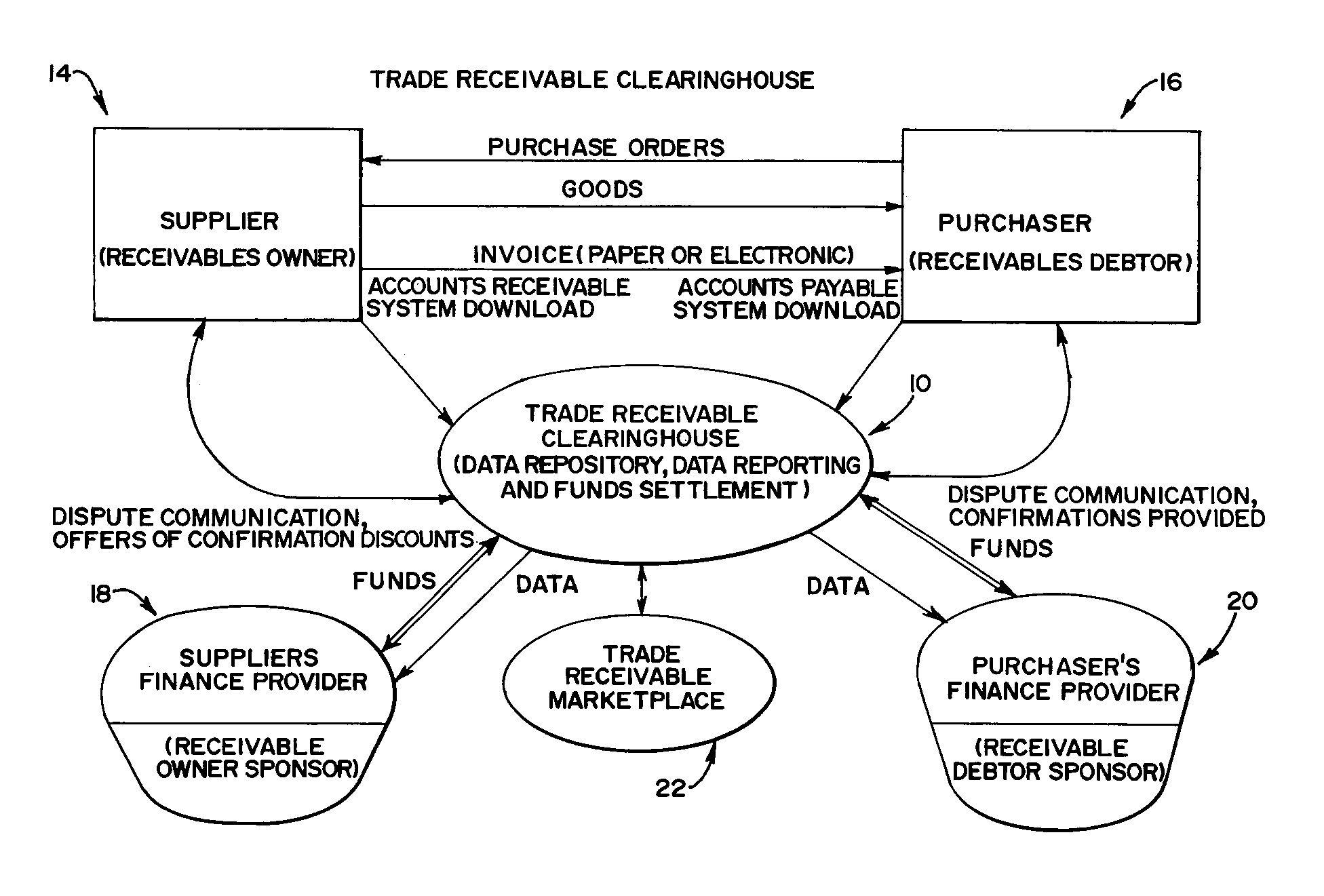

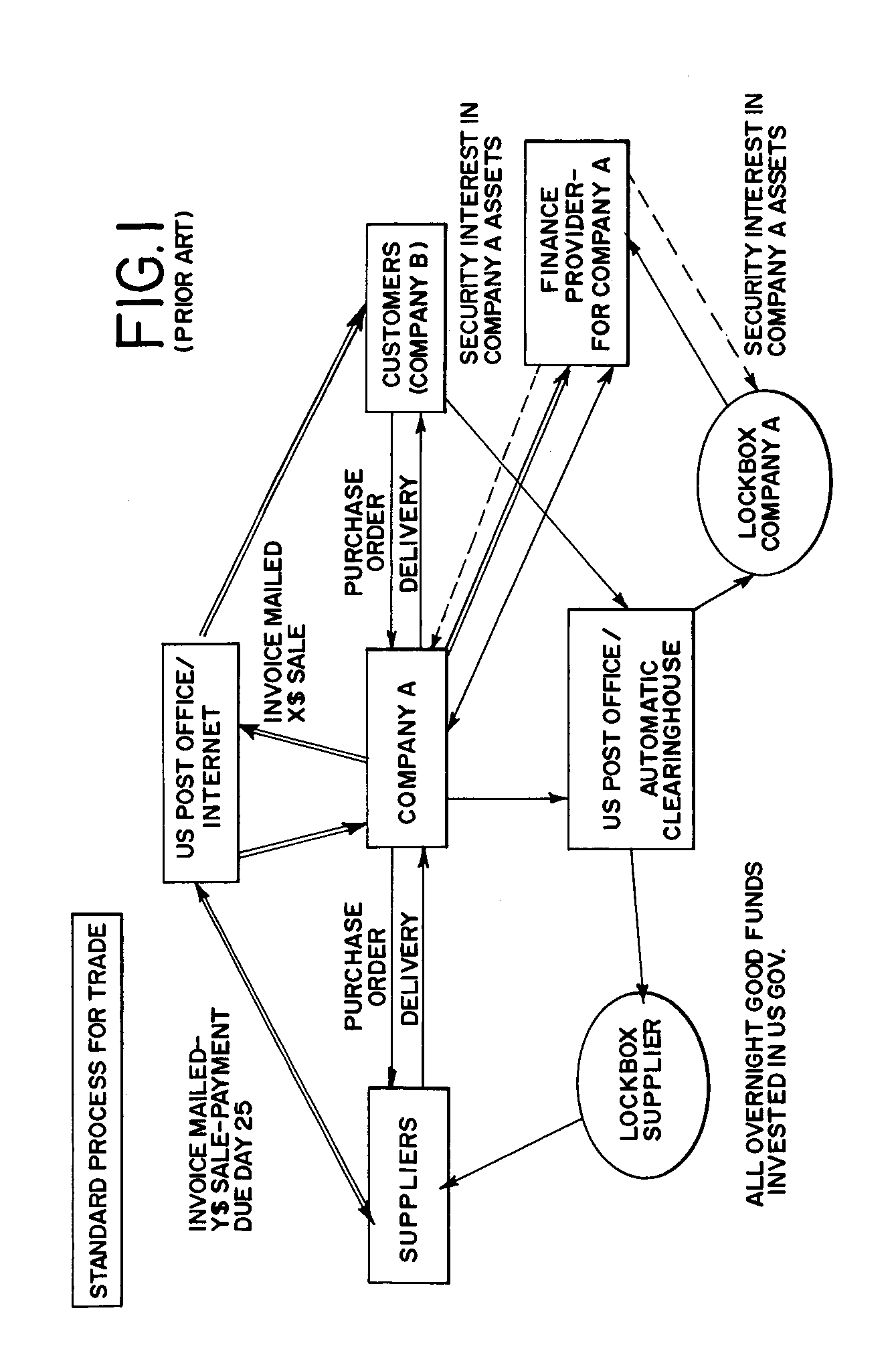

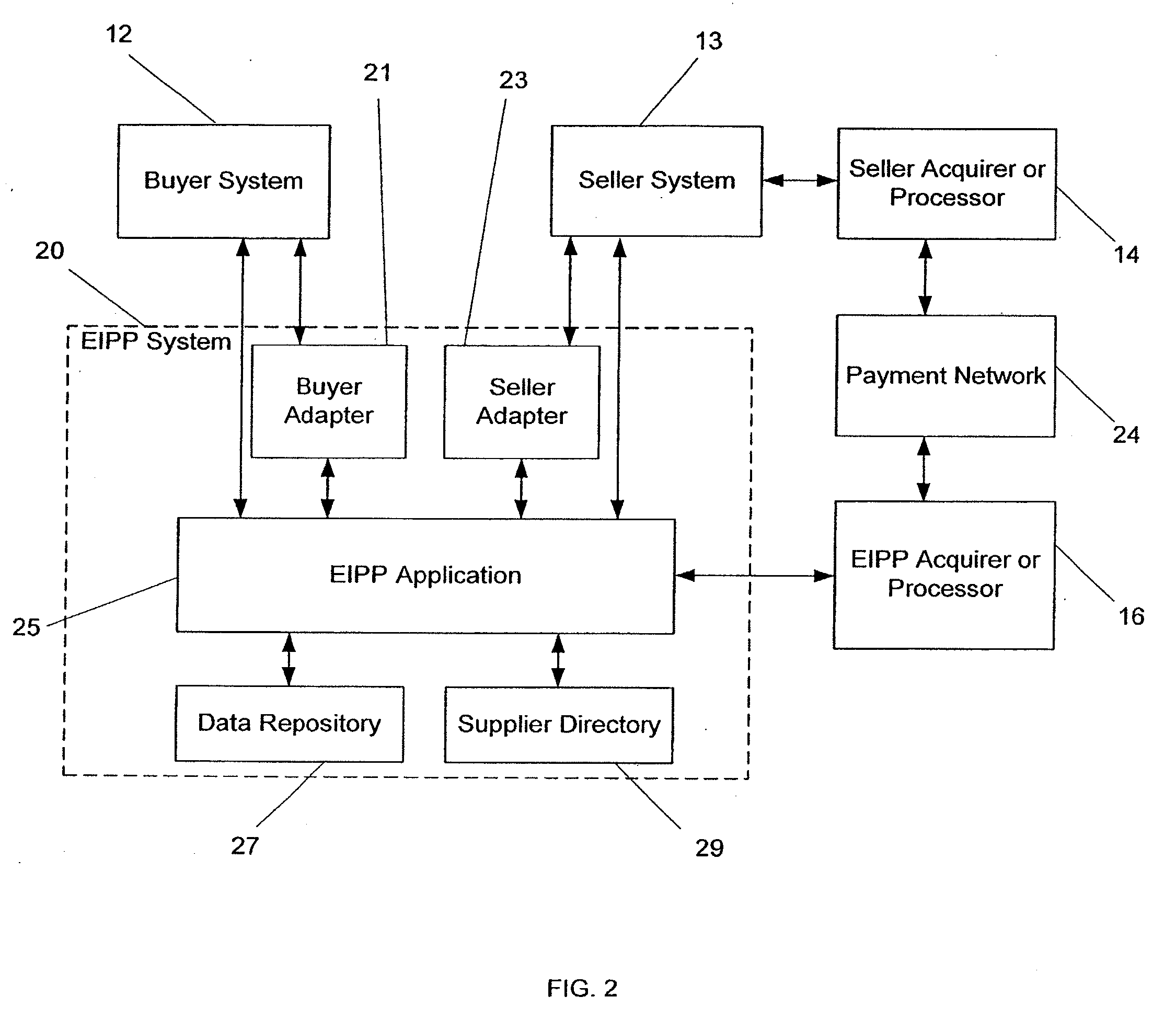

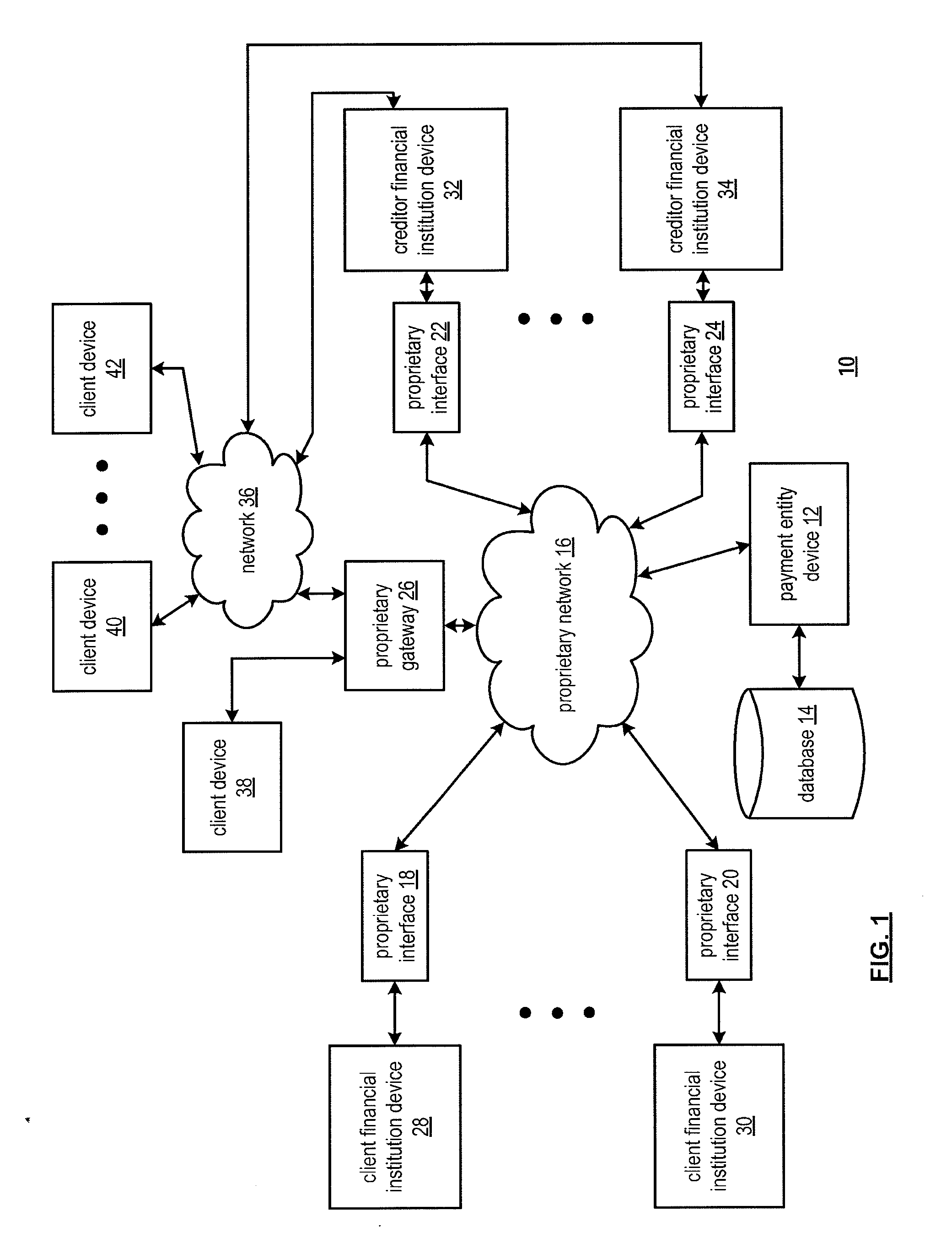

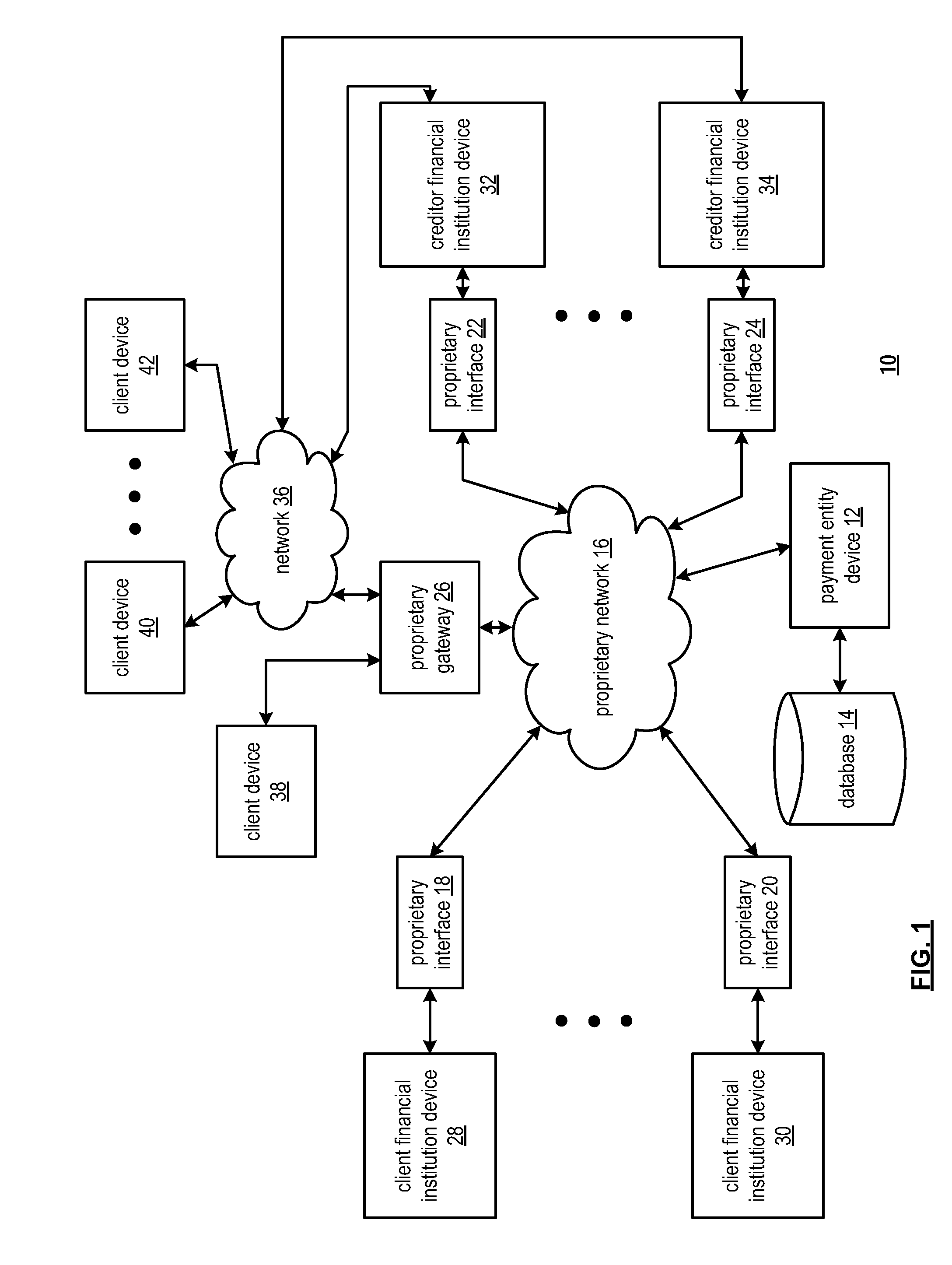

The invention concerns a multiparty accounts receivable and accounts payable system that allows business trading partners to use a single, shared system for both accounts receivable and accounts payable management. The system of the invention forms an electronic “bridge” between a plurality of business trading partners for purposes of invoicing, dispute resolution, financing, and settlement of single and multiple currency debts. As the invoicing and settlement activities of the participants are funneled through a common system, the system allows a participant to aggregate all debts owed to other participants, aggregate all debts owed by the other participants, and net debts owed to other participants with debts owed by these participants. After aggregation and netting, the participant issues a single payment to settle numerous accounts payable items, and receives a single payment that settles numerous accounts receivable items. The system allows participants to use the substantial amount of financial and cash flow information captured by the system to borrow more efficiently by permitting lenders to view this information. Furthermore, the system provides a confirmation process to convert existing debt obligations into a new, independent payment obligation due on a date certain and free of any defenses to the underlying contract. The confirmed debt obligations provide a better source of working capital for the participants, or can be converted into electronic promissory notes. The system provides an electronic exchange for electronic promissory notes, allowing participants to raise working capital in various ways, for example, by selling them.

Owner:JPMORGAN CHASE BANK NA +1

Electronic multiparty accounts receivable and accounts payable system

ActiveUS20070061260A1Efficient and inexpensiveEasy to optimizeFinanceBilling/invoicingAccounts payableInformation capture

The invention concerns a multiparty accounts receivable and accounts payable system that allows business trading partners to use a single, shared system for both accounts receivable and accounts payable management. The system of the invention forms an electronic “bridge” between a plurality of business trading partners for purposes of invoicing, dispute resolution, financing, and settlement of single and multiple currency debts. As the invoicing and settlement activities of the participants are funneled through a common system, the system allows a participant to aggregate all debts owed to other participants, aggregate all debts owed by the other participants, and net debts owed to other participants with debts owed by these participants. After aggregation and netting, the participant issues a single payment to settle numerous accounts payable items, and receives a single payment that settles numerous accounts receivable items. The system allows participants to use the substantial amount of financial and cash flow information captured by the system to borrow more efficiently by permitting lenders to view this information. Furthermore, the system provides a confirmation process to convert existing debt obligations into a new, independent payment obligation due on a date certain and free of any defenses to the underlying contract. The confirmed debt obligations provide a better source of working capital for the participants, or can be converted into electronic promissory notes. The system provides an electronic exchange for electronic promissory notes, allowing participants to raise working capital in various ways, for example, by selling them.

Owner:JPMORGAN CHASE BANK NA

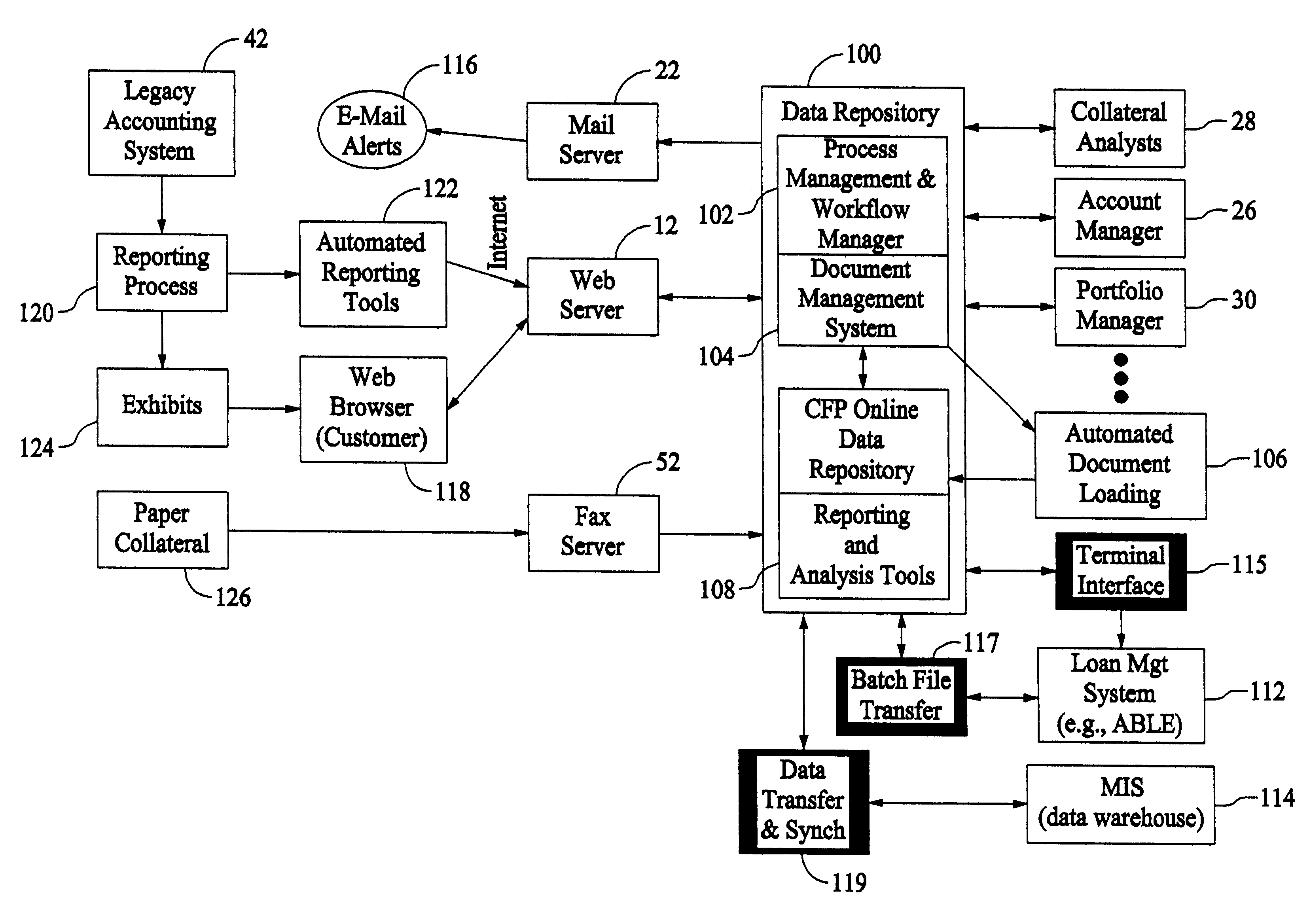

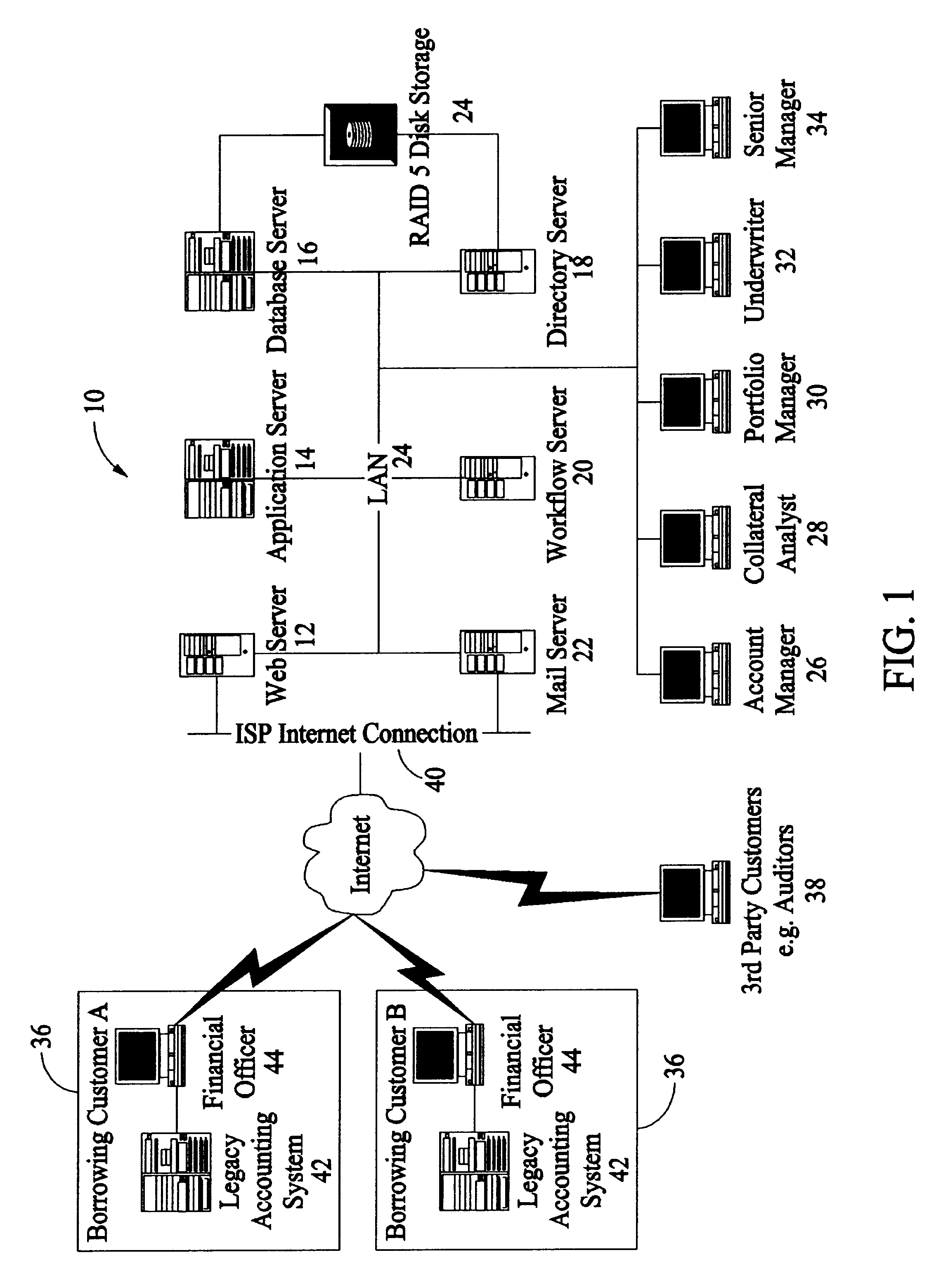

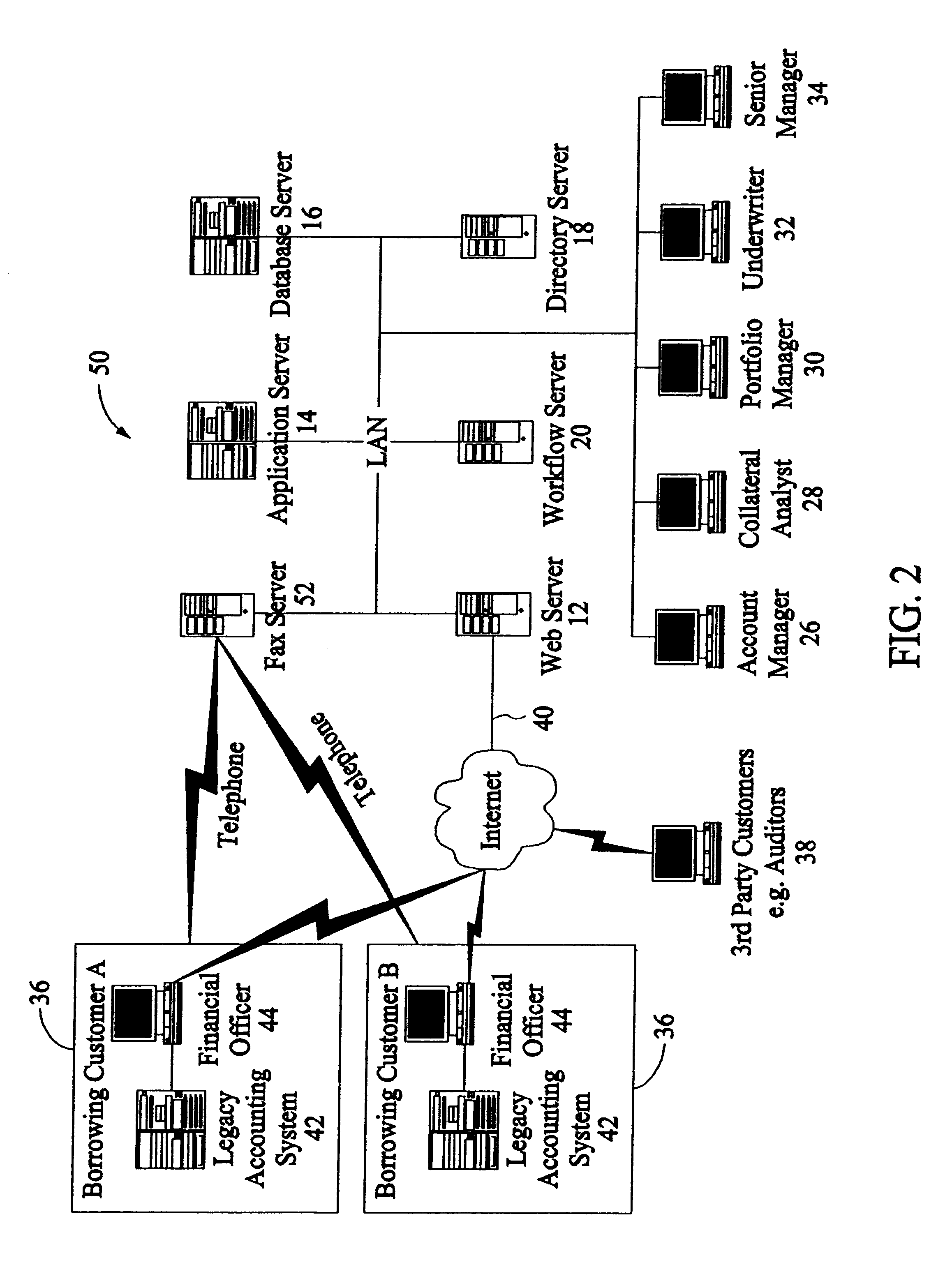

Methods and apparatus for collateral risk monitoring

Methods and Apparatus for monitoring collateral risk are described. In one embodiment, the method includes monitoring, for example, accounts receivable, accounts payable, inventory, trading partners, chart of accounts, invoices, and / or payments of a client using a process management and workflow system coupled to a data repository. Specifically, and in an exemplary embodiment, the method includes receiving financial information, extracting data from the financial information, evaluating current collateral information based on the data, and evaluating current credit status.

Owner:GENERAL ELECTRIC CO

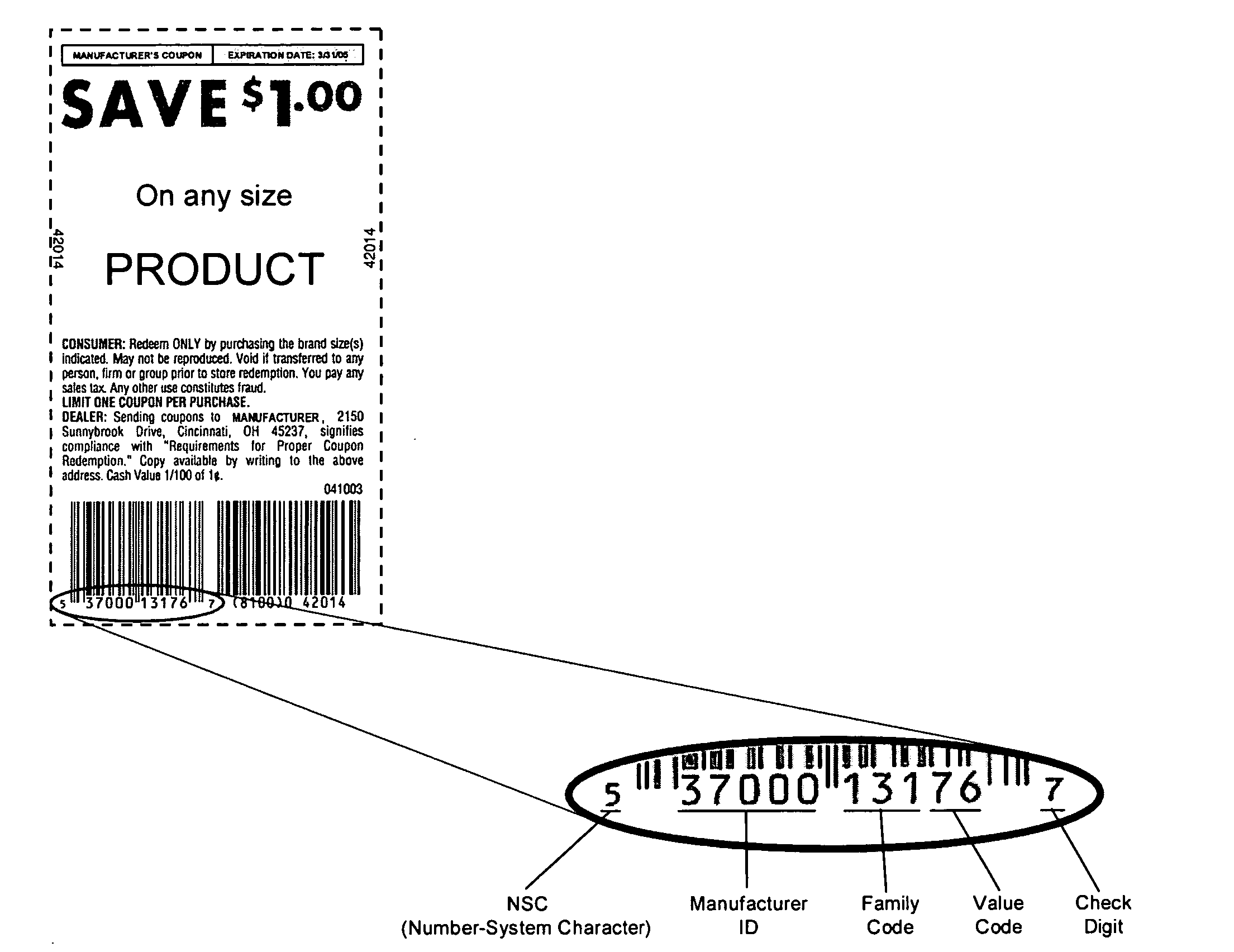

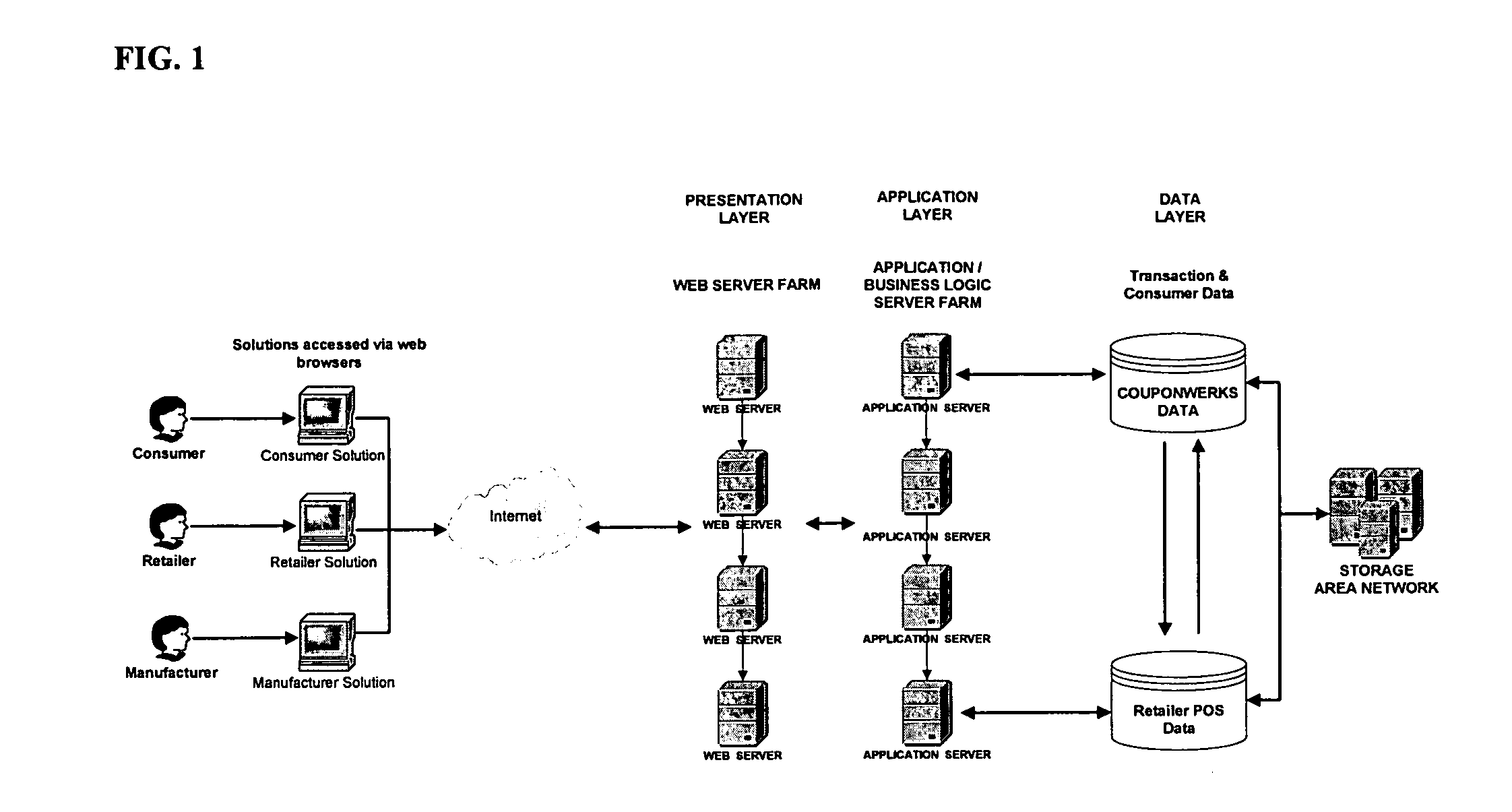

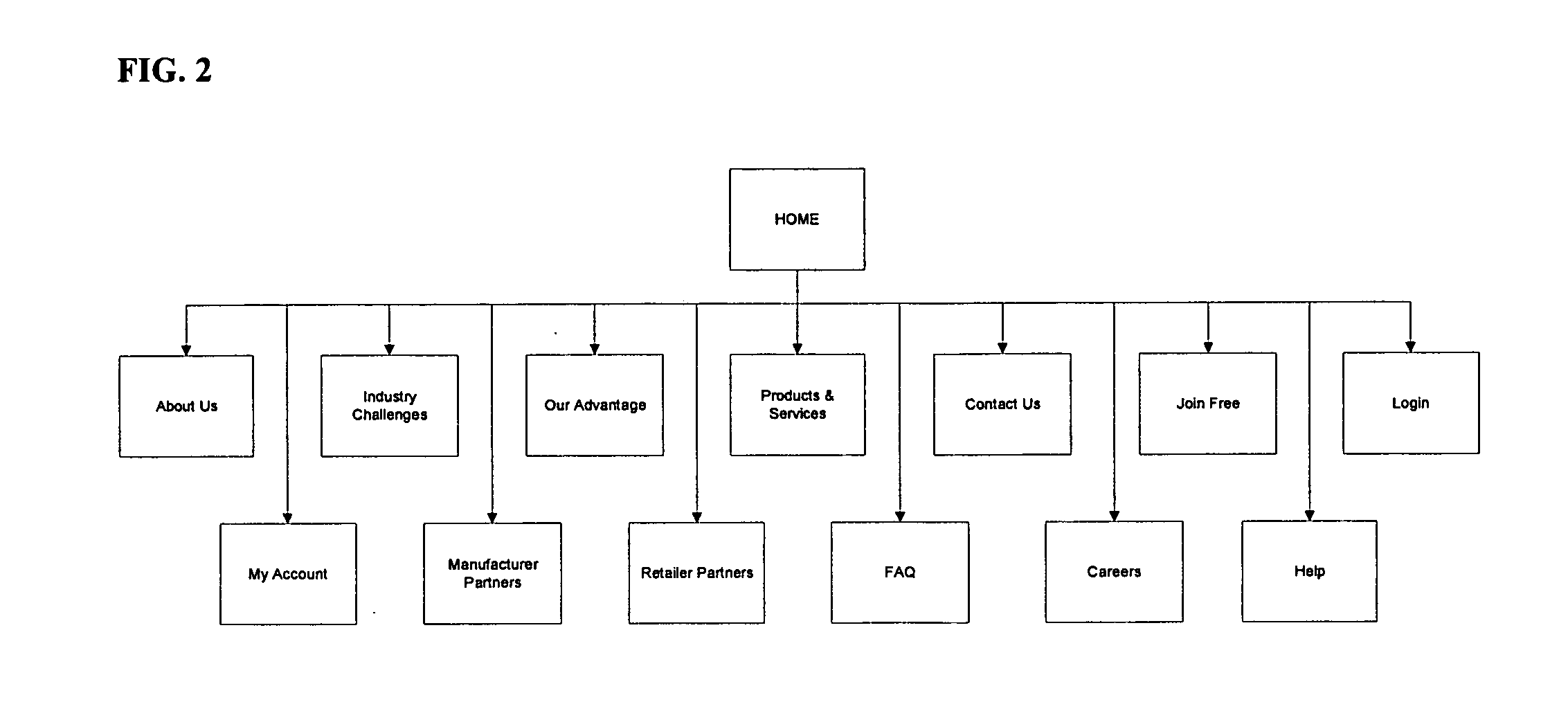

Computer system for facilitating the use of coupons for electronic presentment and processing

A computer system for promotion management, analytics and interactive marketing enabling consumers, retailers and product manufacturers to administer all of these activities electronically and in real-time. Consumers have the ability to store paper coupon data and Internet coupon data to an account accessible through the use of a grocery loyalty card, a different type of card, cell phone, PDA, key ring transponder or other portable device or the like capable of storing electronic account data. Online reporting capabilities enable manufacturers and retailers to track and analyze promotion performance, redemption payments, sales dollars, unit volume, accounts receivable, accounts payable and other important data. Manufacturers and retailers have the ability to communicate directly with individual customers or groups of customers to promote their products and services. The system is accessible to consumers, manufacturers and retailers via PC, cell phone, PDA or any device with Internet capabilities.

Owner:SPROVIERI JOSEPH J +1

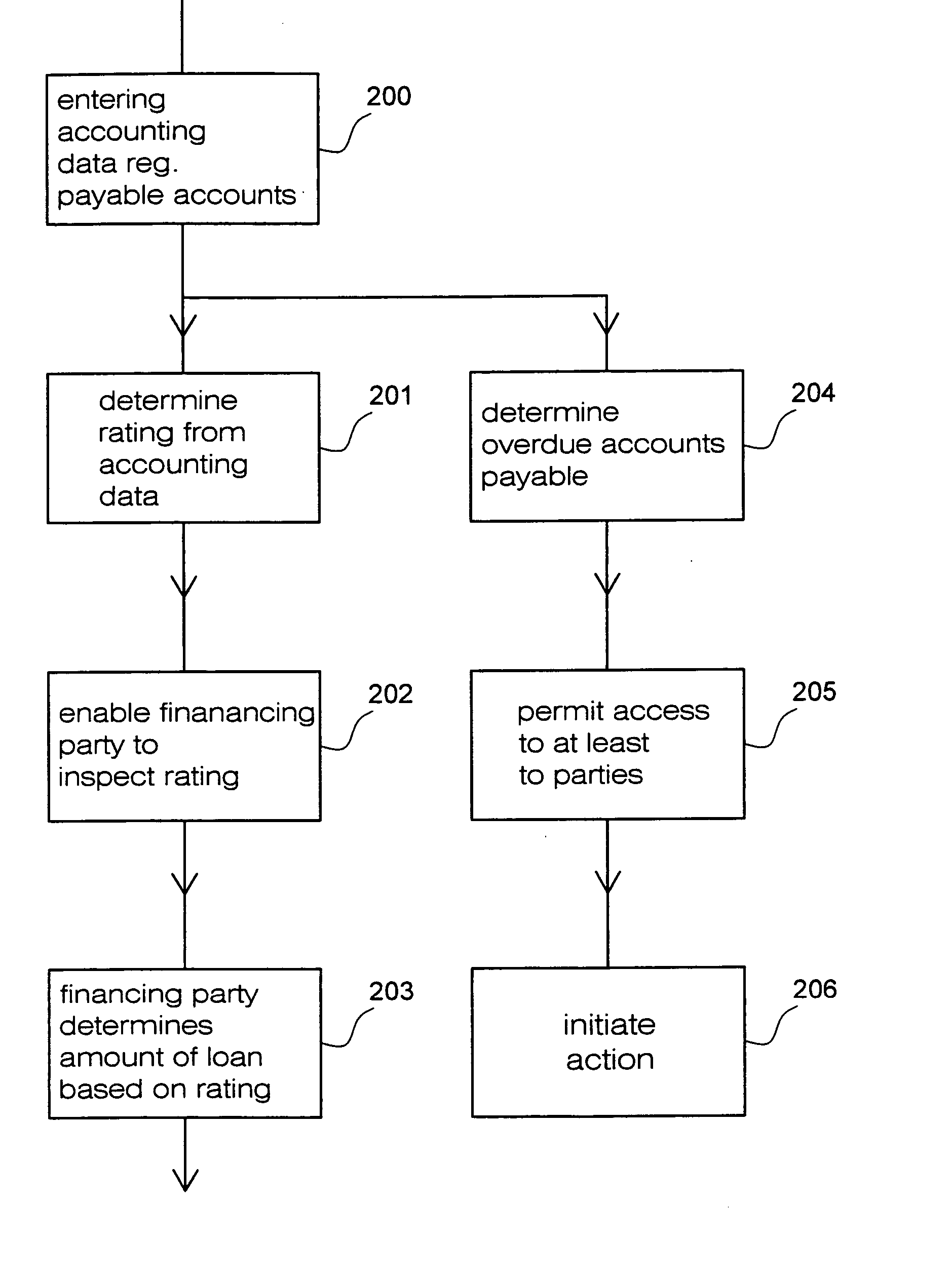

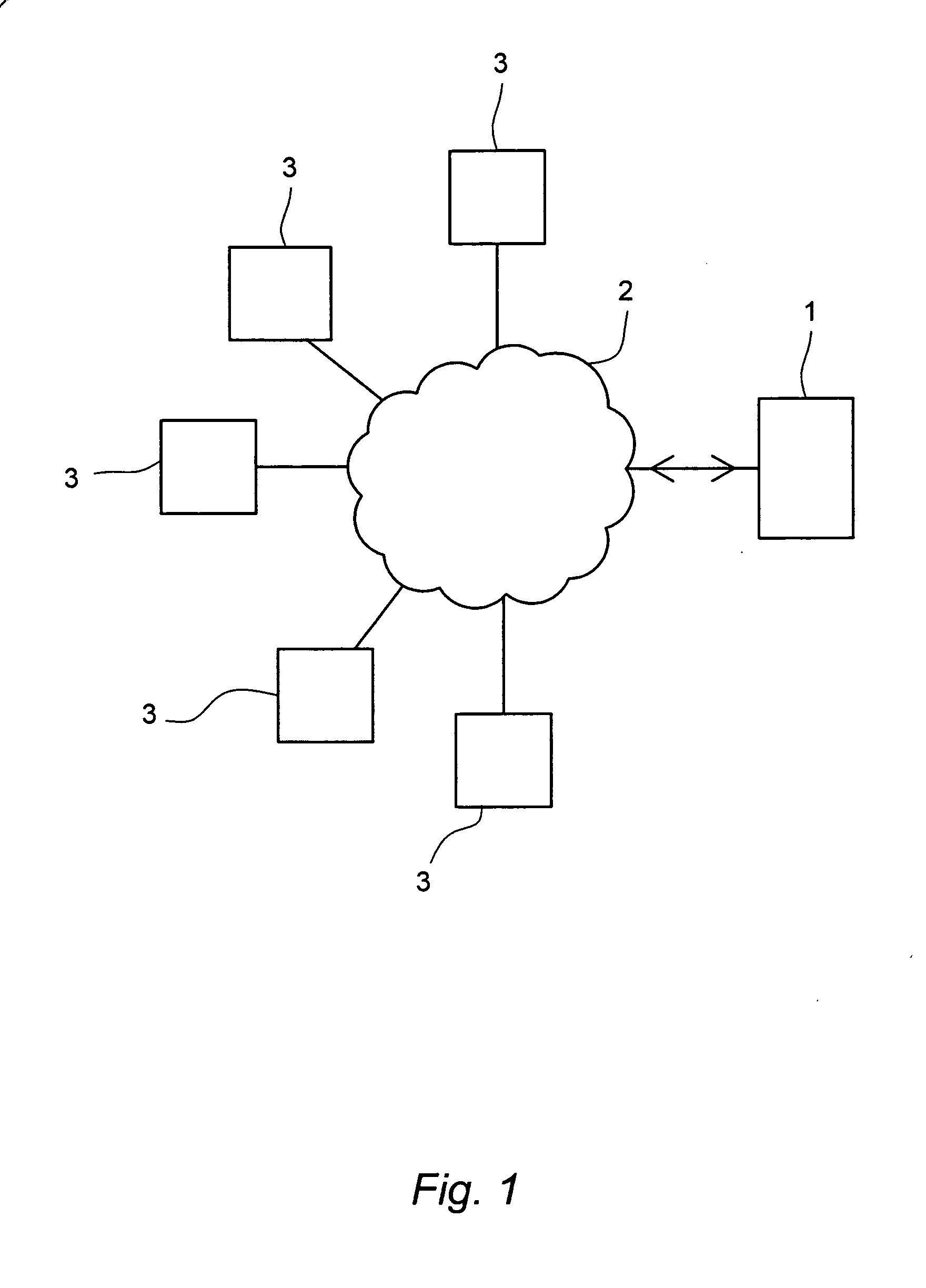

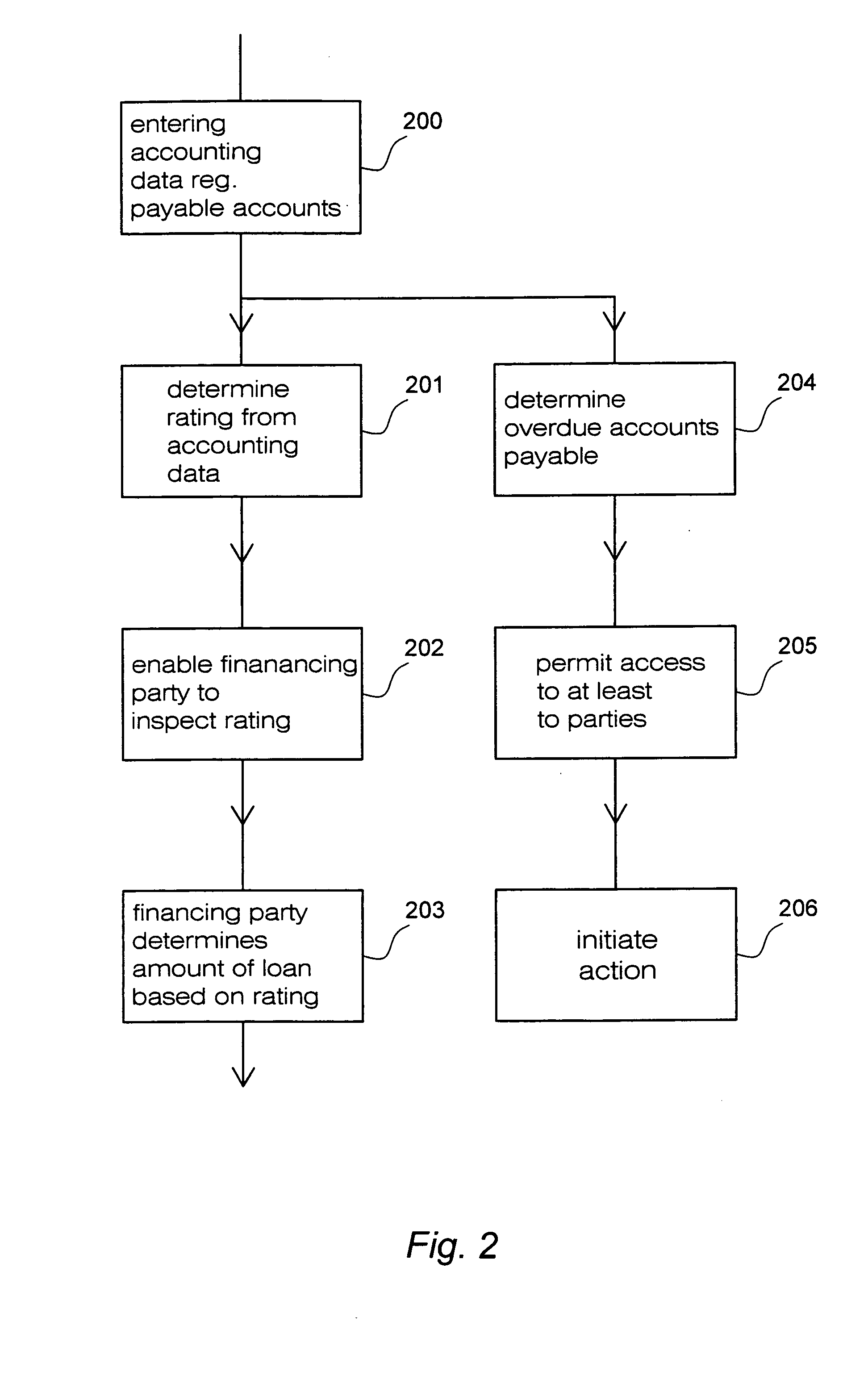

Debt collecting and financing method

Owner:LAMERS WILHELMUS J M

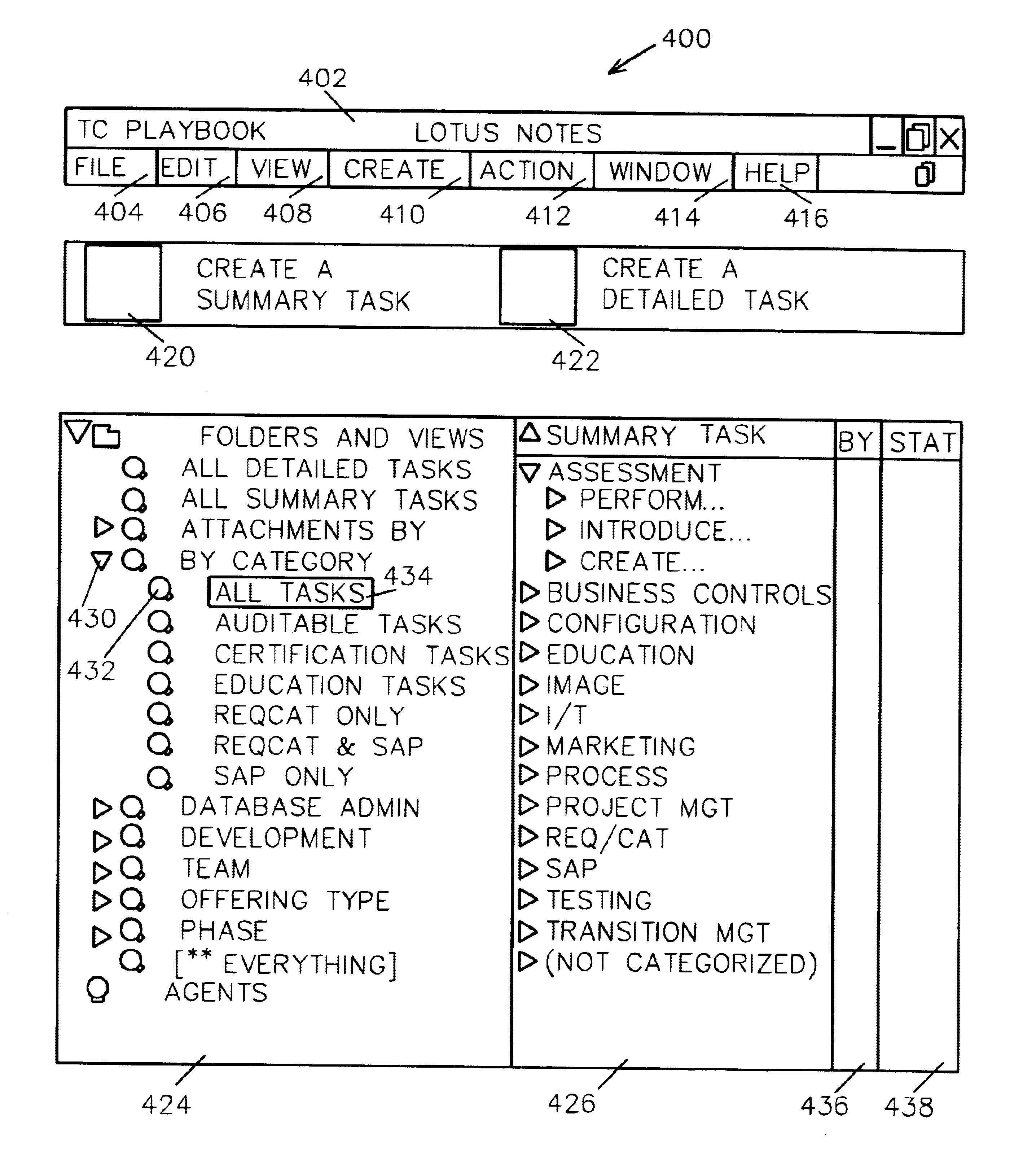

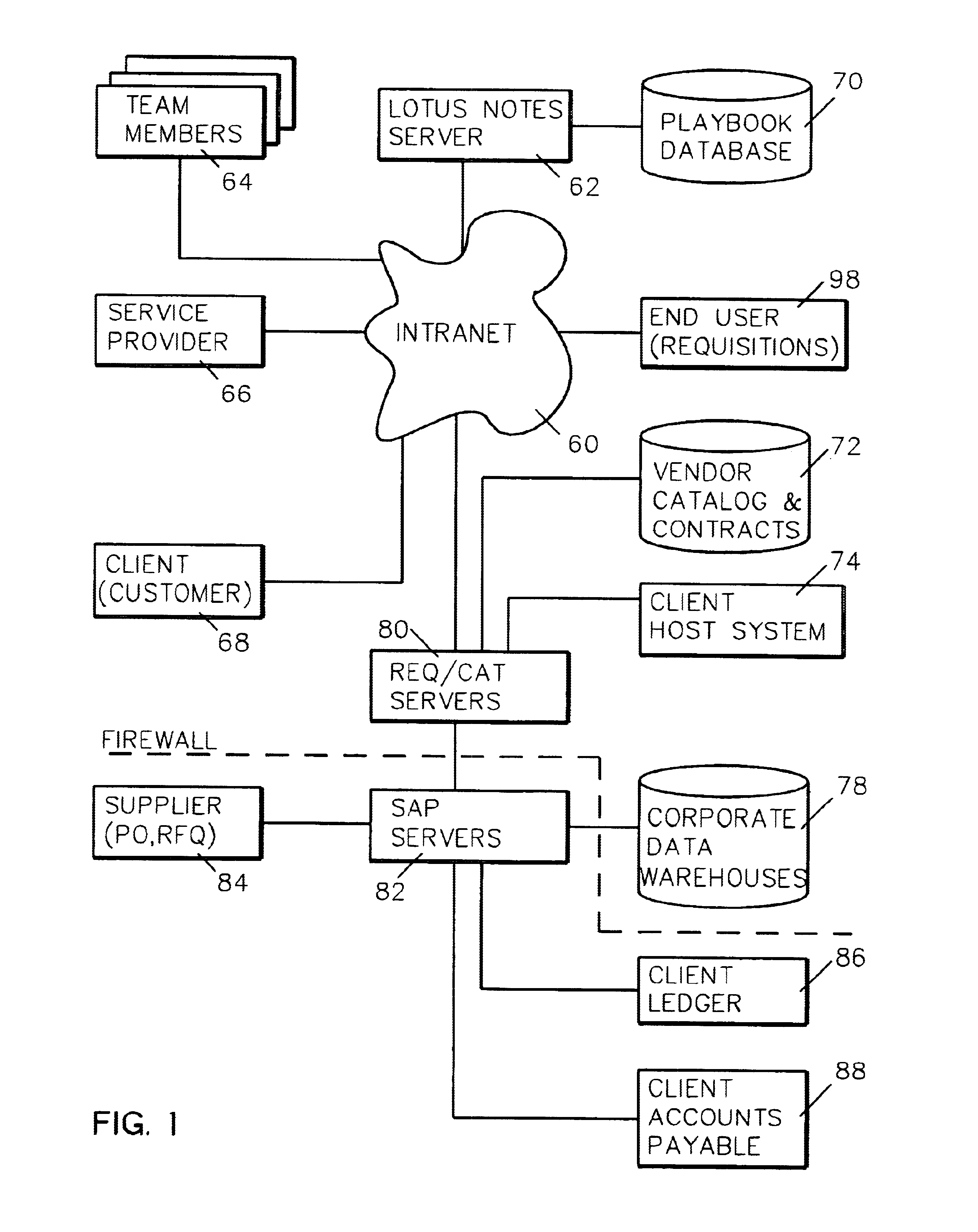

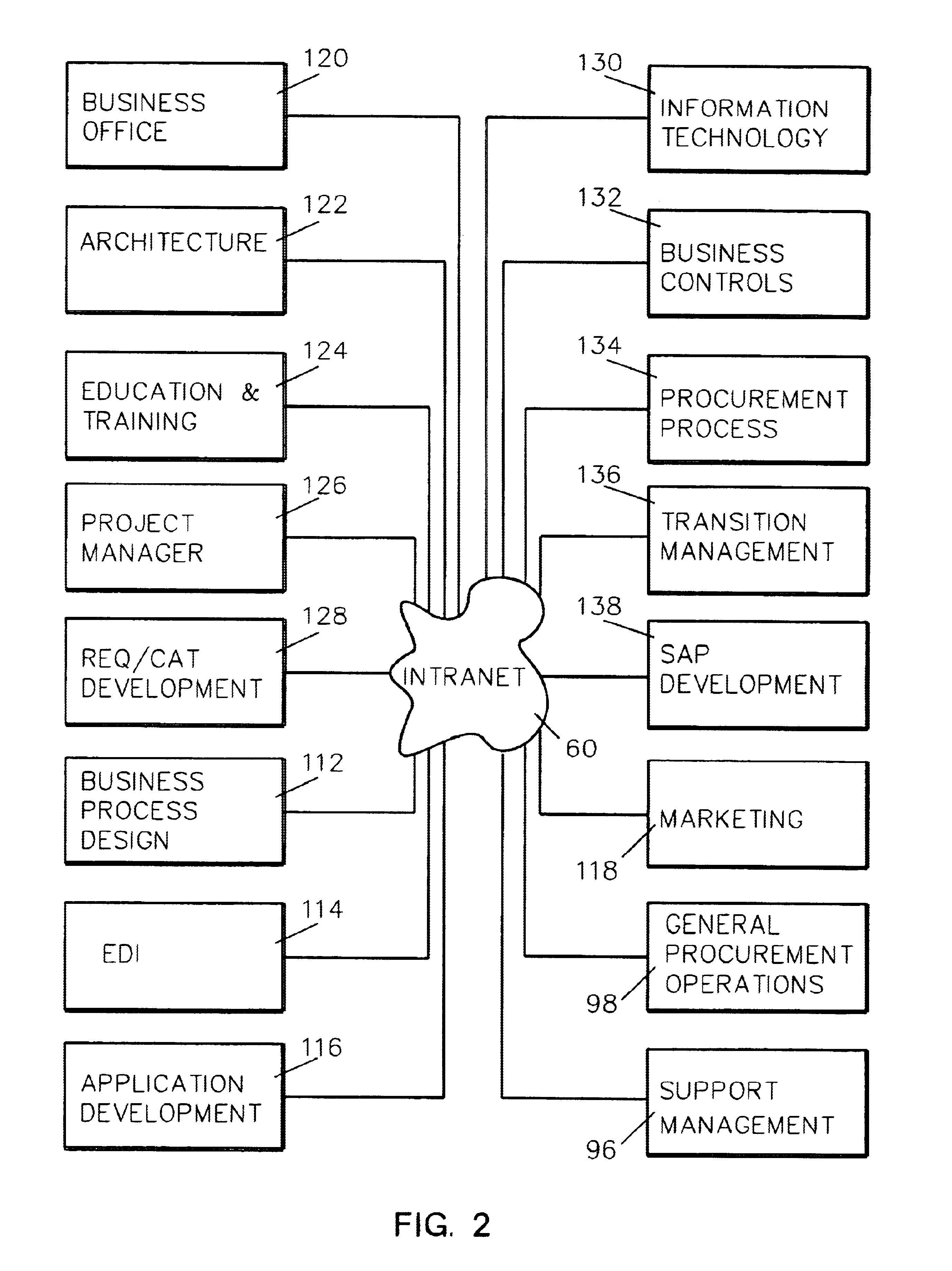

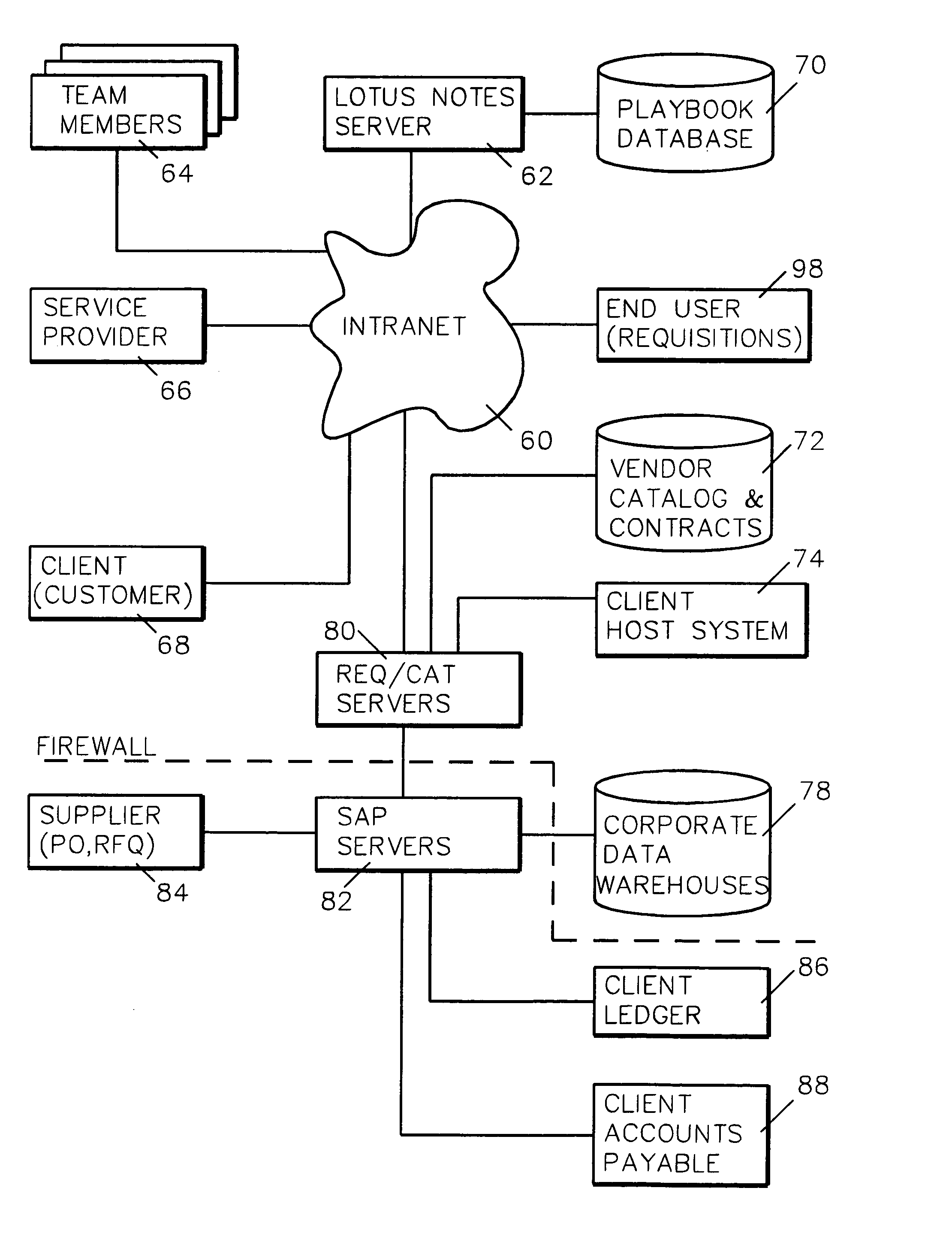

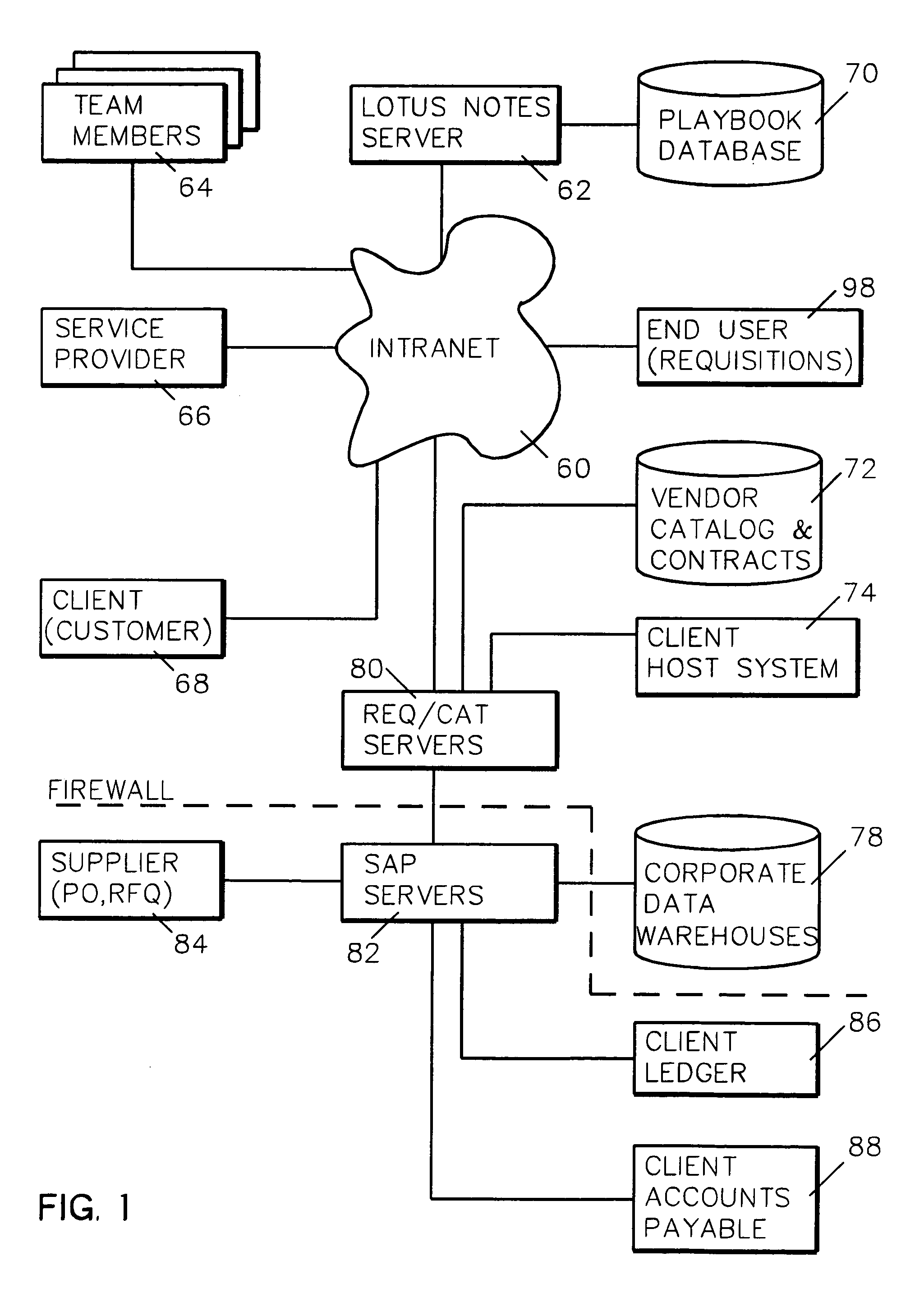

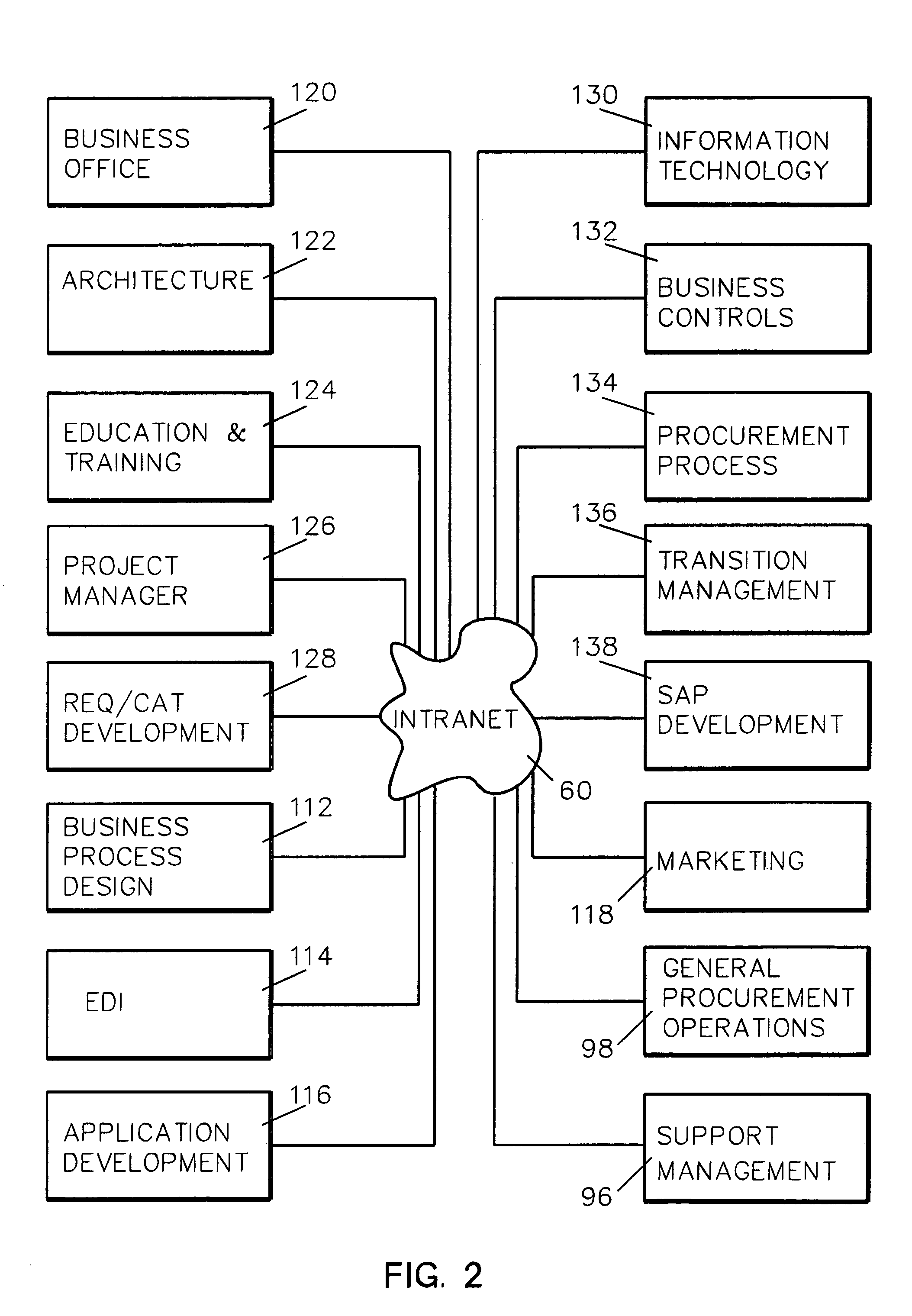

System and method for assessing a procurement and accounts payable system

A system for deploying to a client accounting installation a general procurement and accounts payable application specifically configured for the client by an enterprise includes a database server for (1) maintaining on a storage device a database of templates describing procedures for assessing, preparing, developing, deploying and supporting the application, and for (2) serving these templates to team members operating web-enabled terminals for coordinating, recording and tracking team activities with respect to the application while generating a description for adapting a front end server and an accounting system server to the requirements of the client.

Owner:PAYPAL INC

System and method for project designing and developing a procurement and accounts payable system

A system for deploying to a client accounting installation a general procurement and accounts payable application specifically configured for the client by an enterprise includes a database server for (1) maintaining on a storage device a database of templates describing procedures for assessing, preparing, developing, deploying and supporting the application, and for (2) serving these templates to team members operating web-enabled terminals for coordinating, recording and tracking team activities with respect to the application while generating a description for adapting a front end server and an accounting system server to the requirements of the client.

Owner:EBAY INC

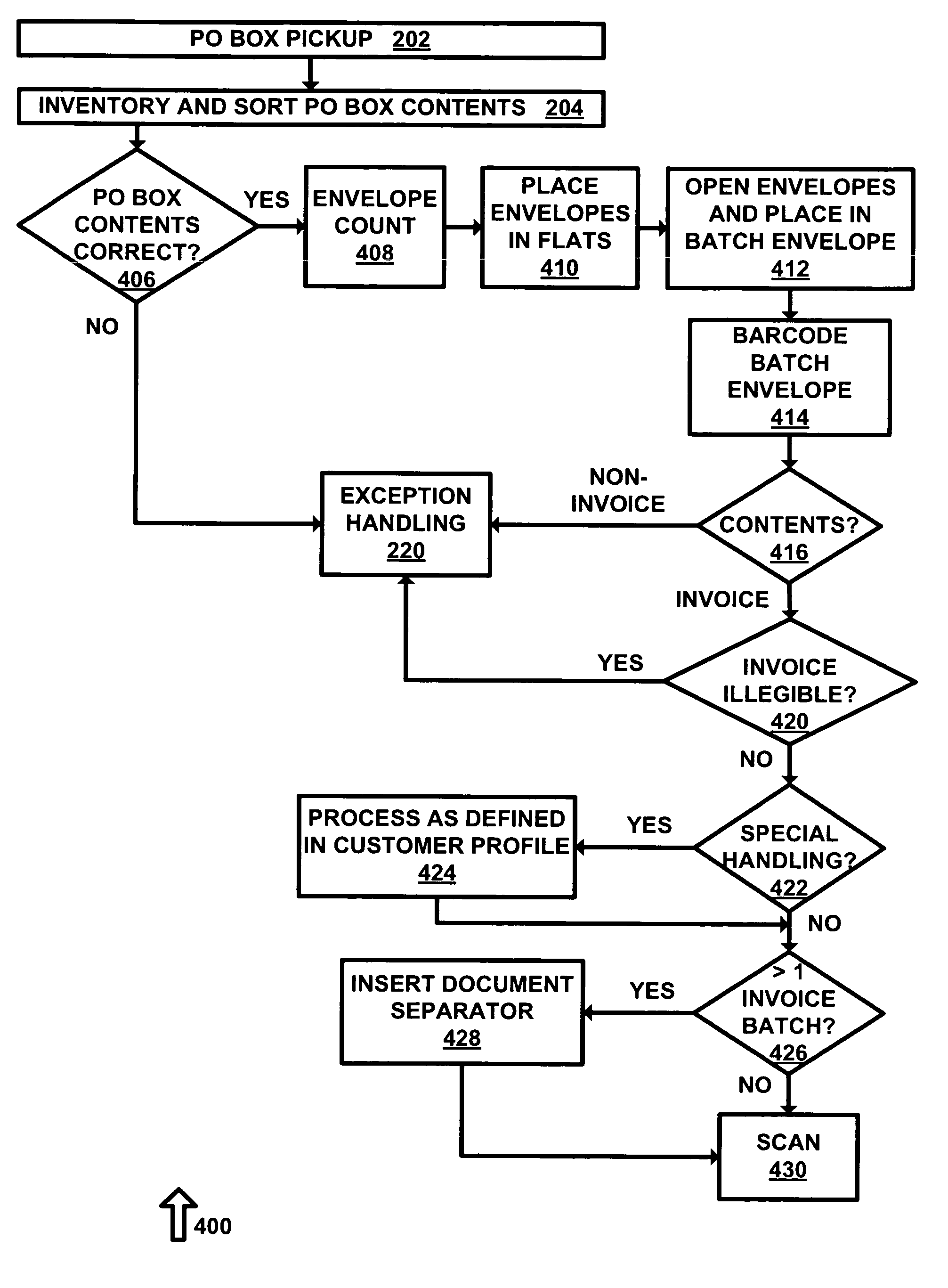

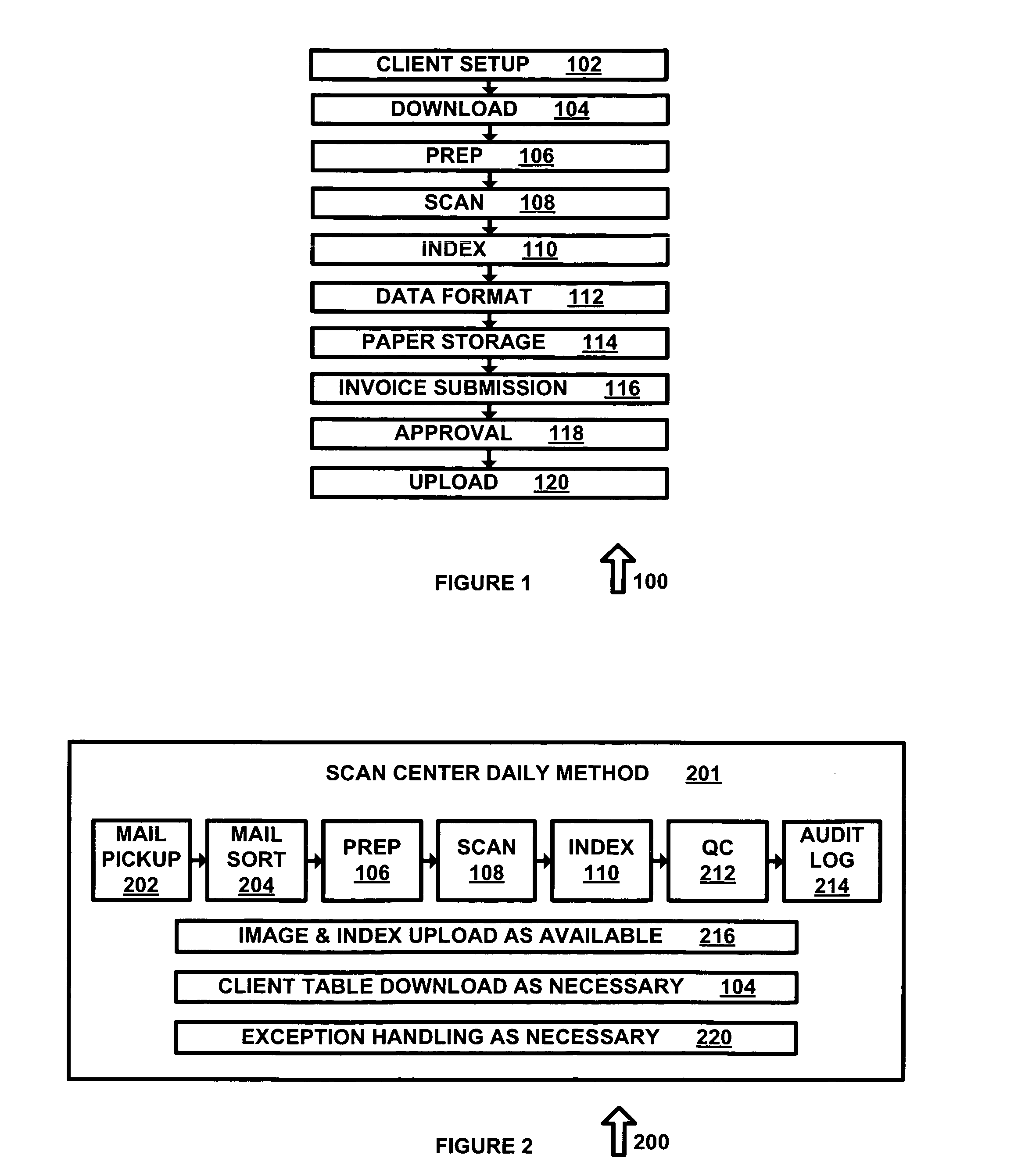

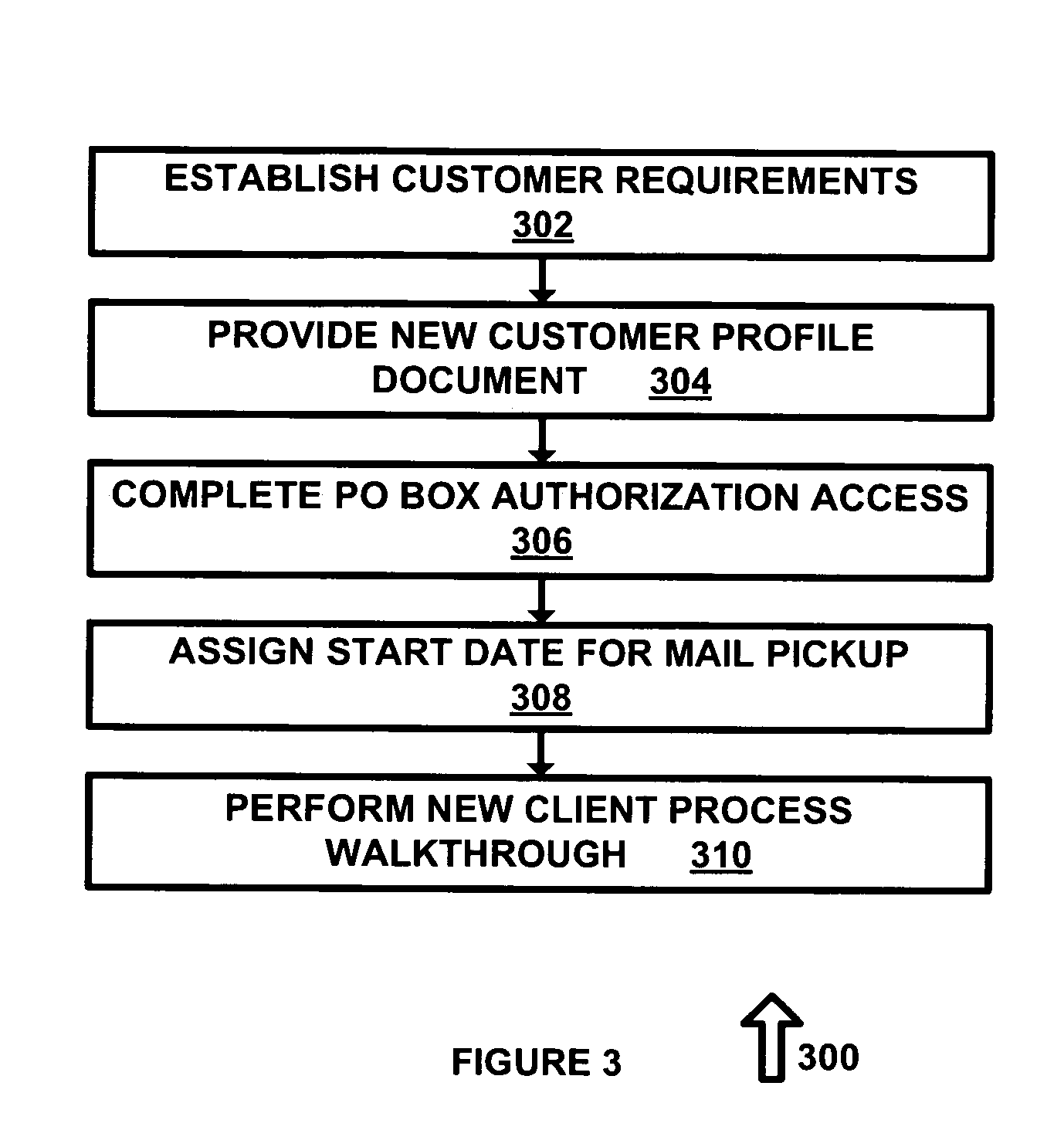

System and method for invoice management

InactiveUS20080177643A1Low costEasy to controlComplete banking machinesFinanceData fieldAccounts payable

A managed invoice management system is provided that eliminates paper and manual functions from the accounts payable process. The system allows a user to digitize invoices, extract key data, add general ledger codes, and validate invoices against purchase orders for each of a plurality of clients, based on a client profile containing predetermined allowable data fields. The system electronically routes invoices from input to one or more approval personnel, wherein the approval personnel are user-selectable from the client profile, and provides real-time invoice tracking and expense analysis.

Owner:INSITE SERVICES

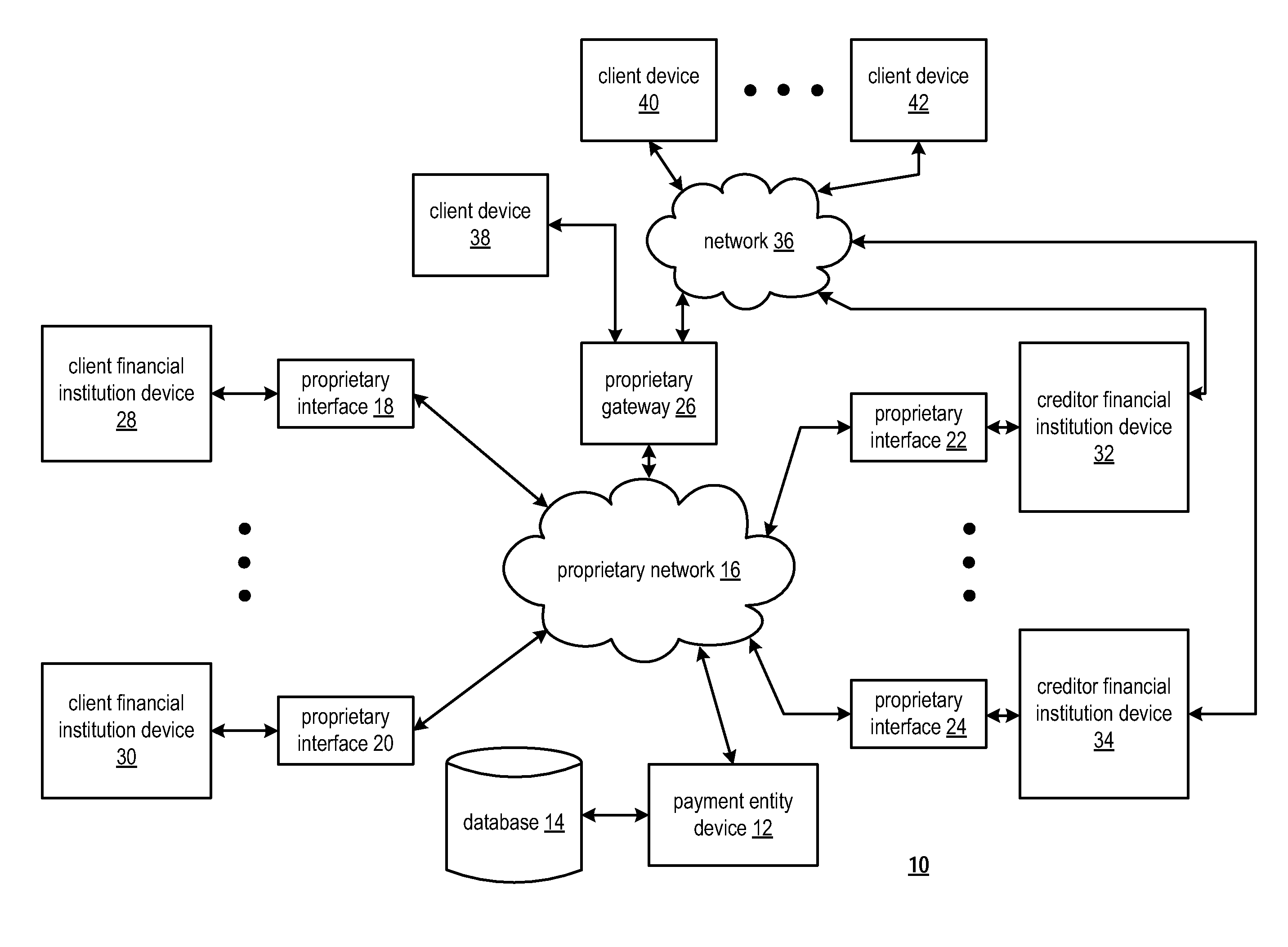

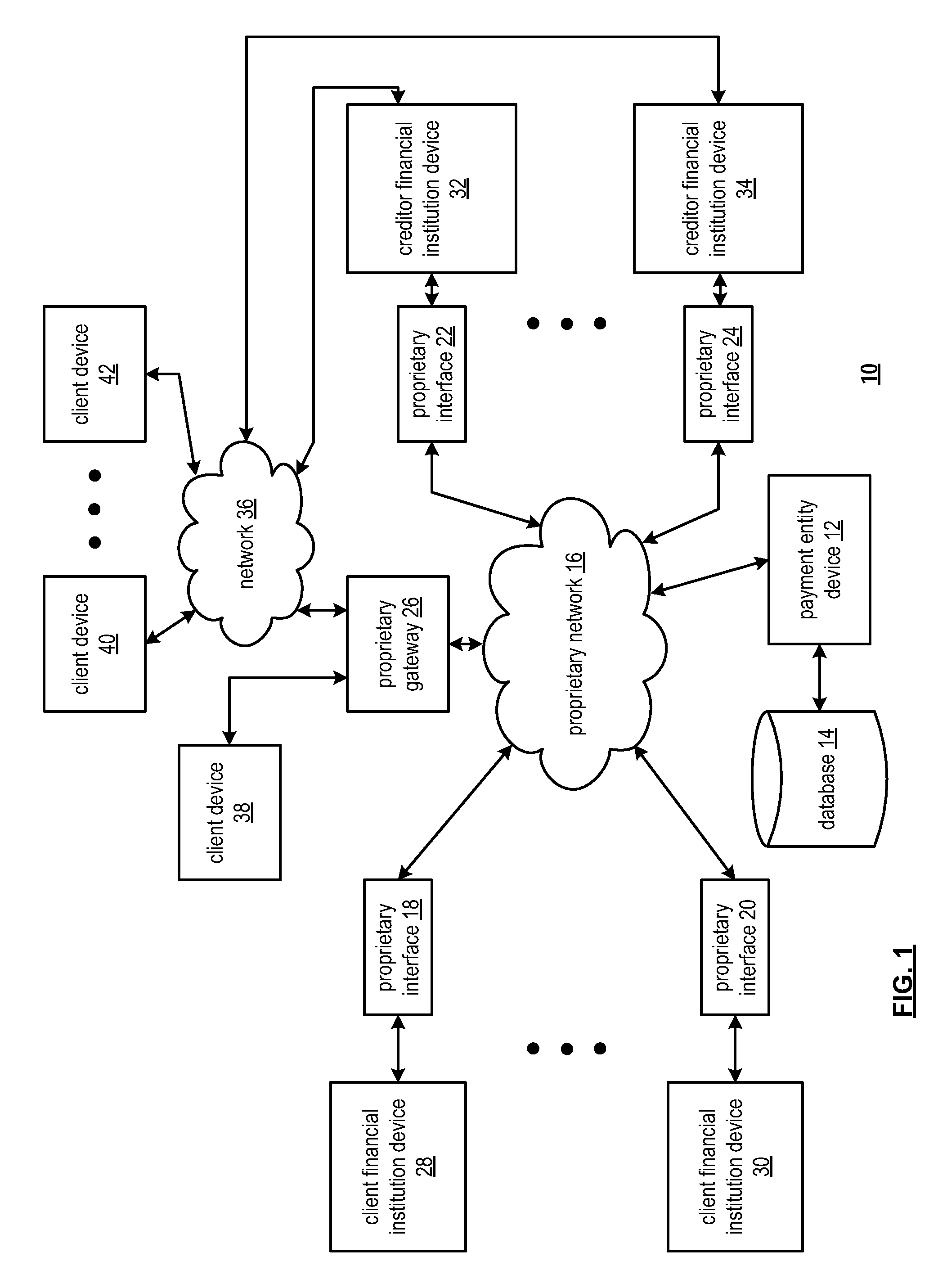

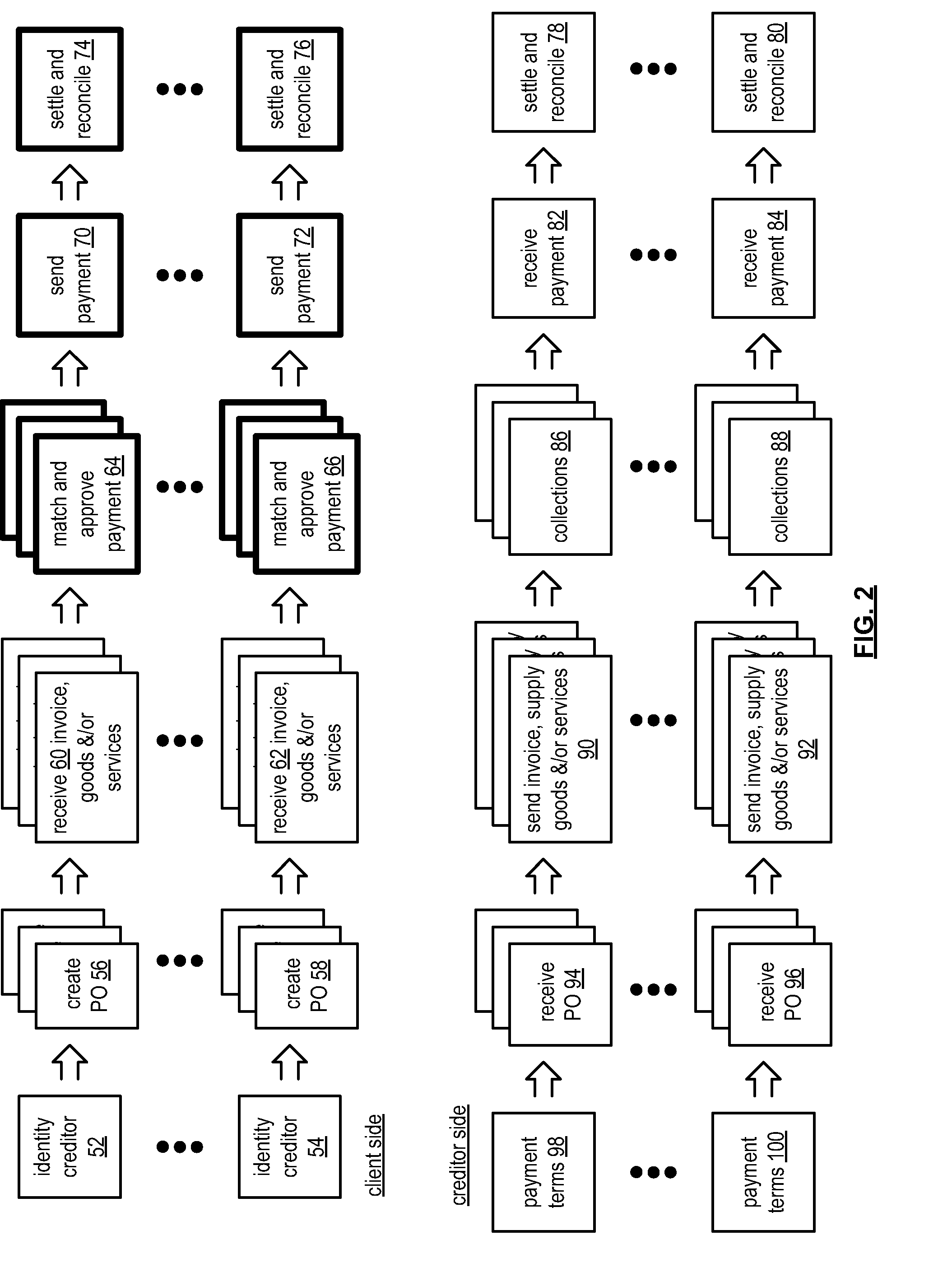

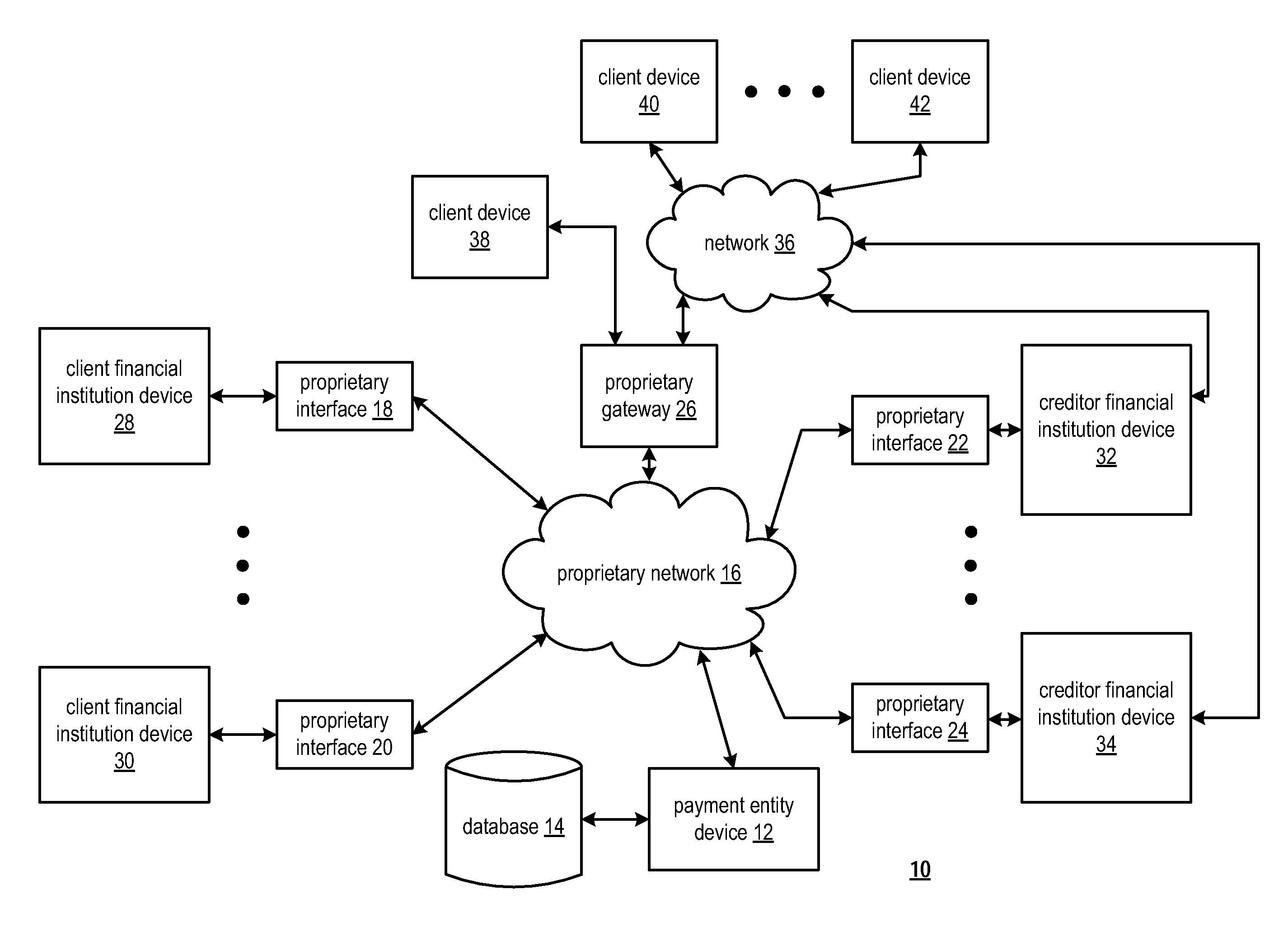

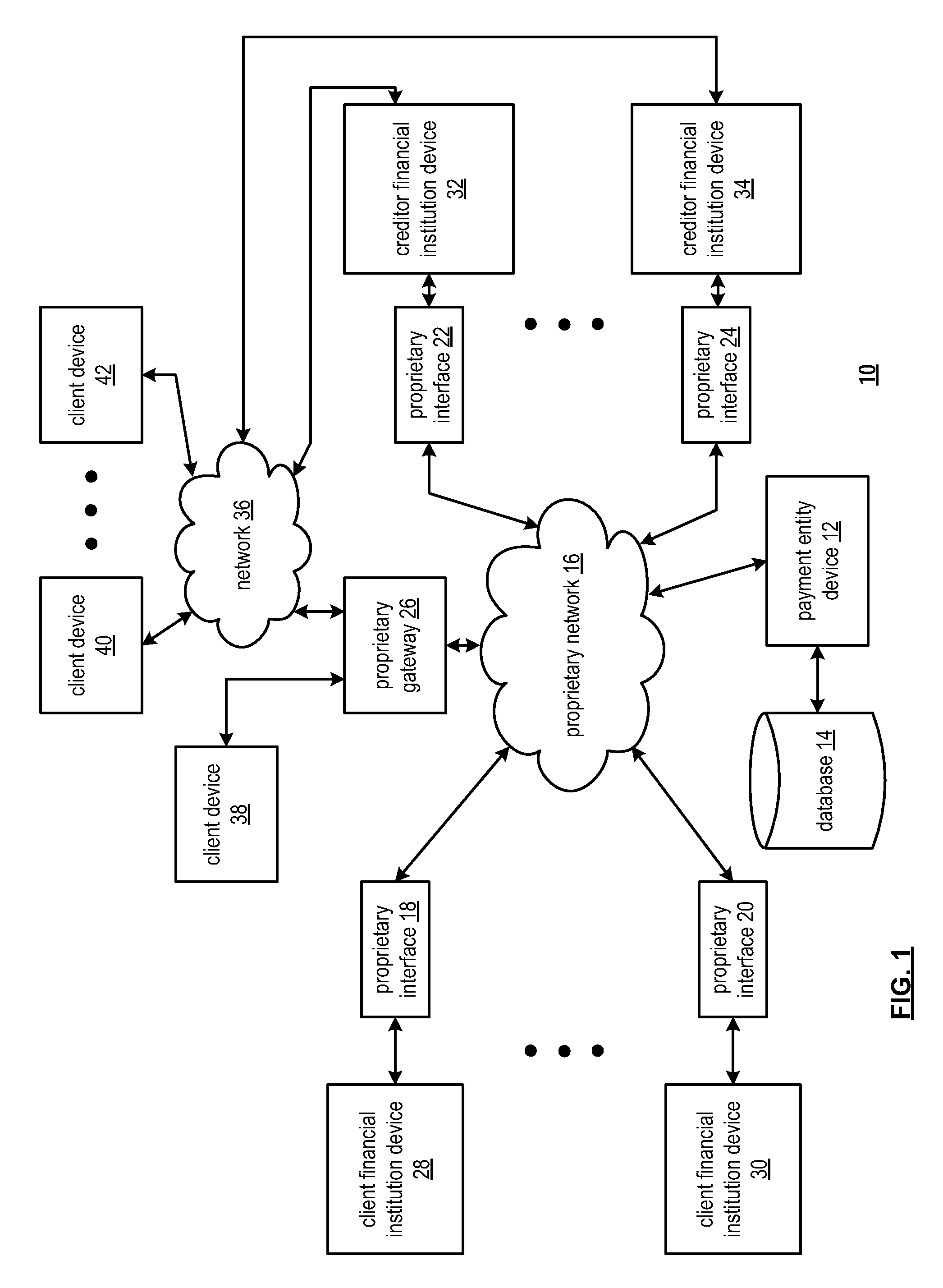

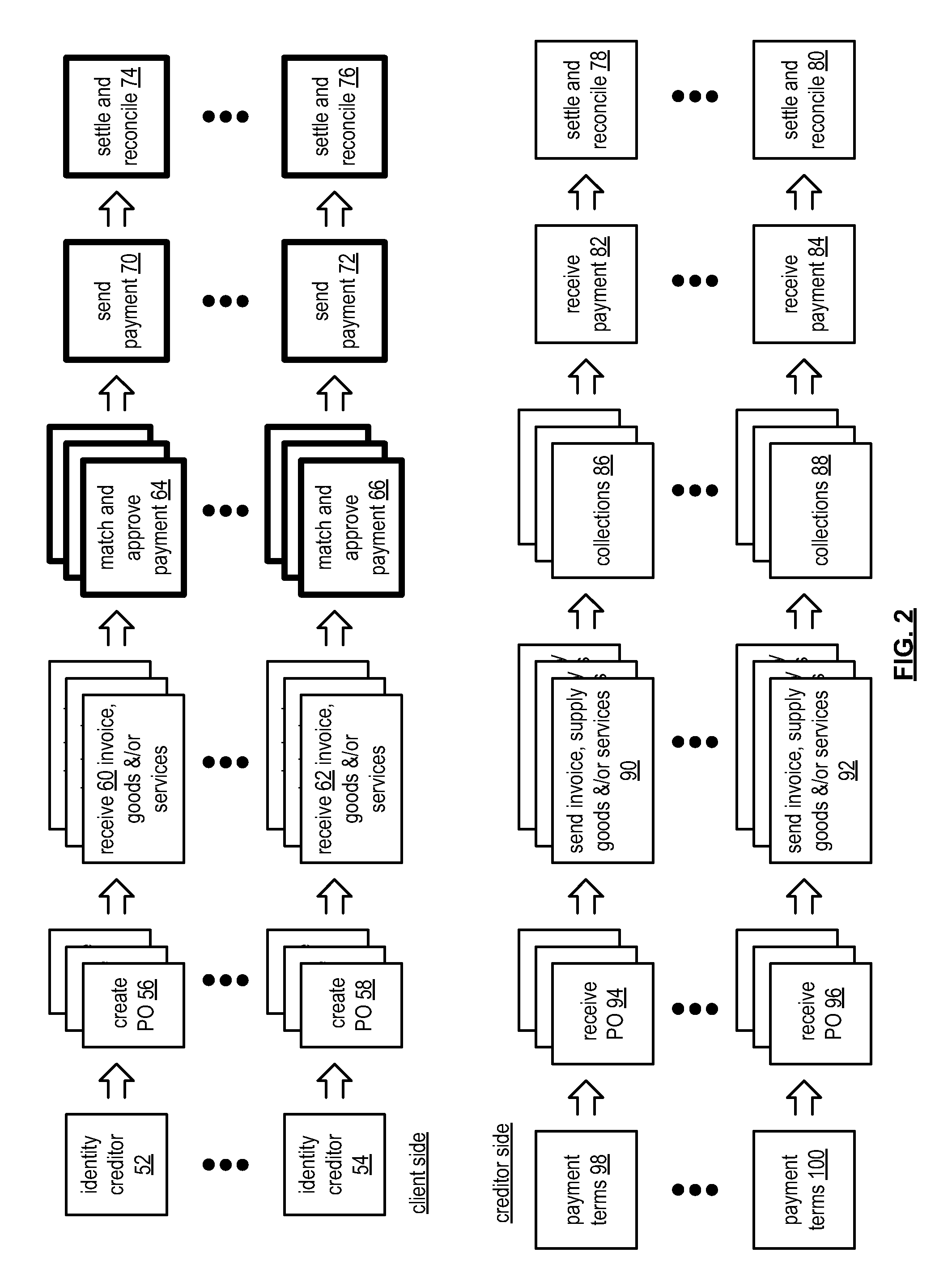

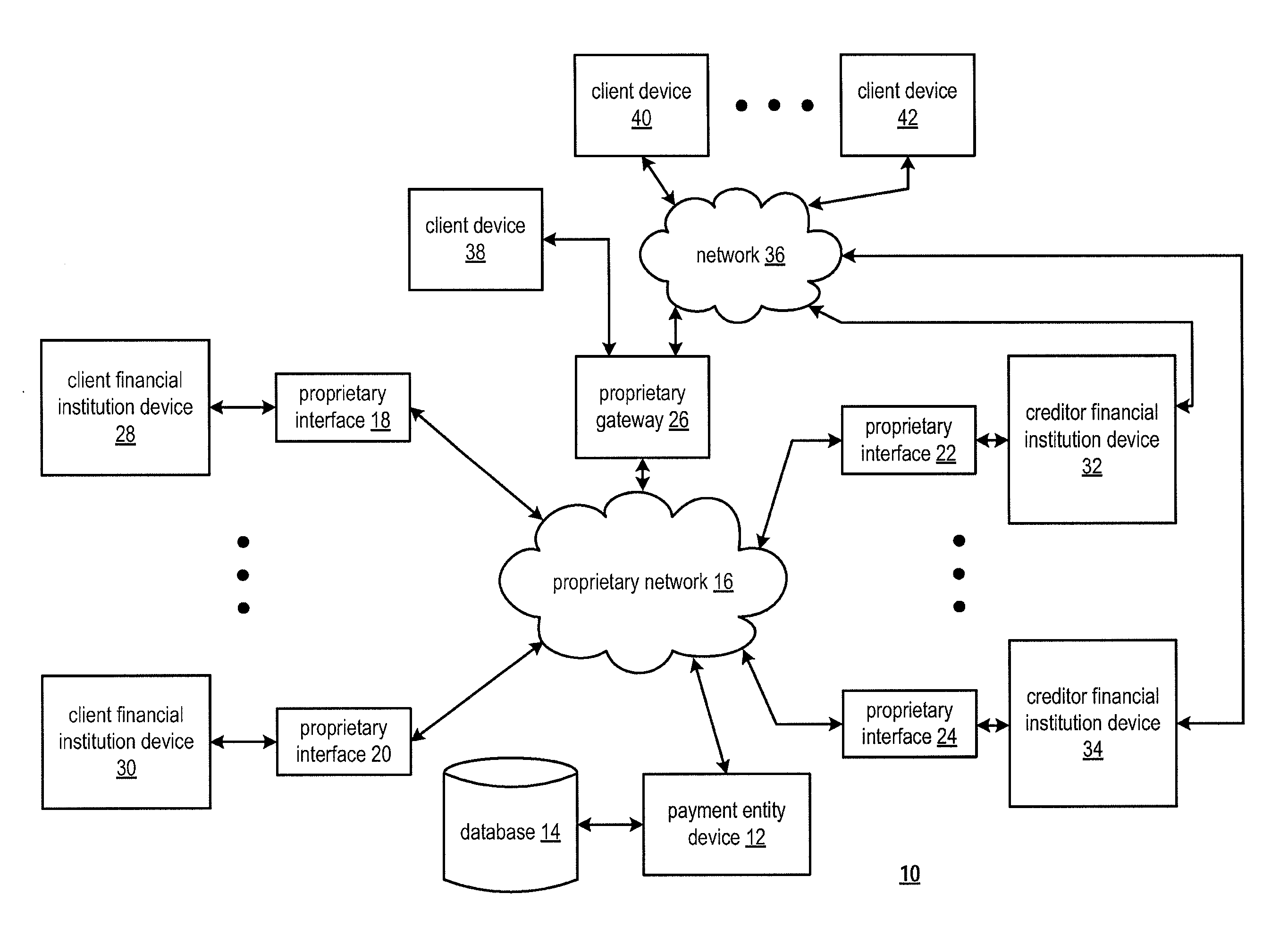

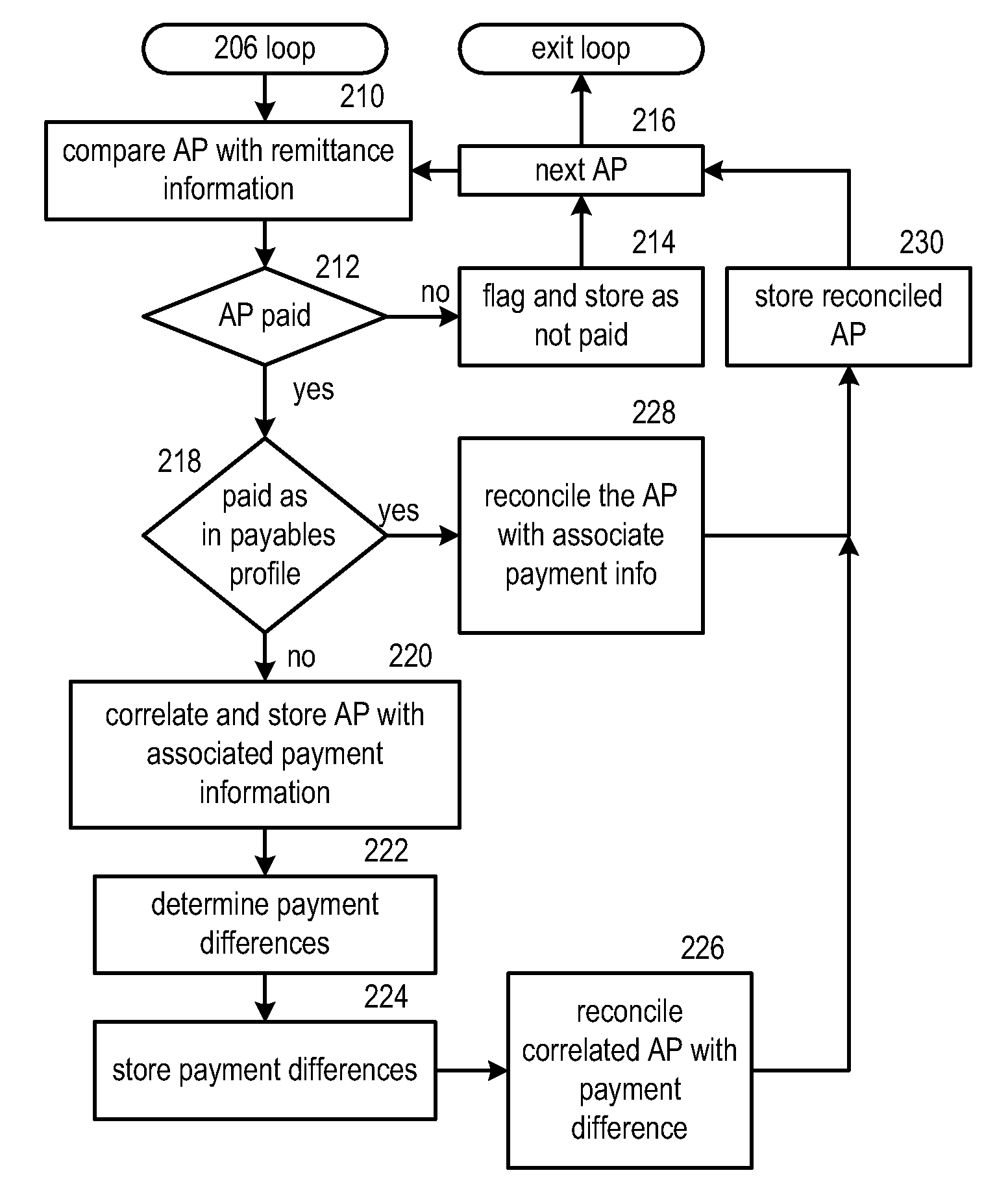

Payment entity device reconciliation for multiple payment methods

A method begins by storing payment request data, which, for a client, includes a payables profile and an accounts payable data file. The method continues by receiving payment remittance information subsequent to initiation of a payment in accordance with the payment request data. The method continues by storing the payment remittance information. The method continues by consolidating the payment remittance information and the payment request data to produce consolidated payment data. The method continues by generating at least one report based on the consolidated payment data.

Owner:VISA USA INC (US)

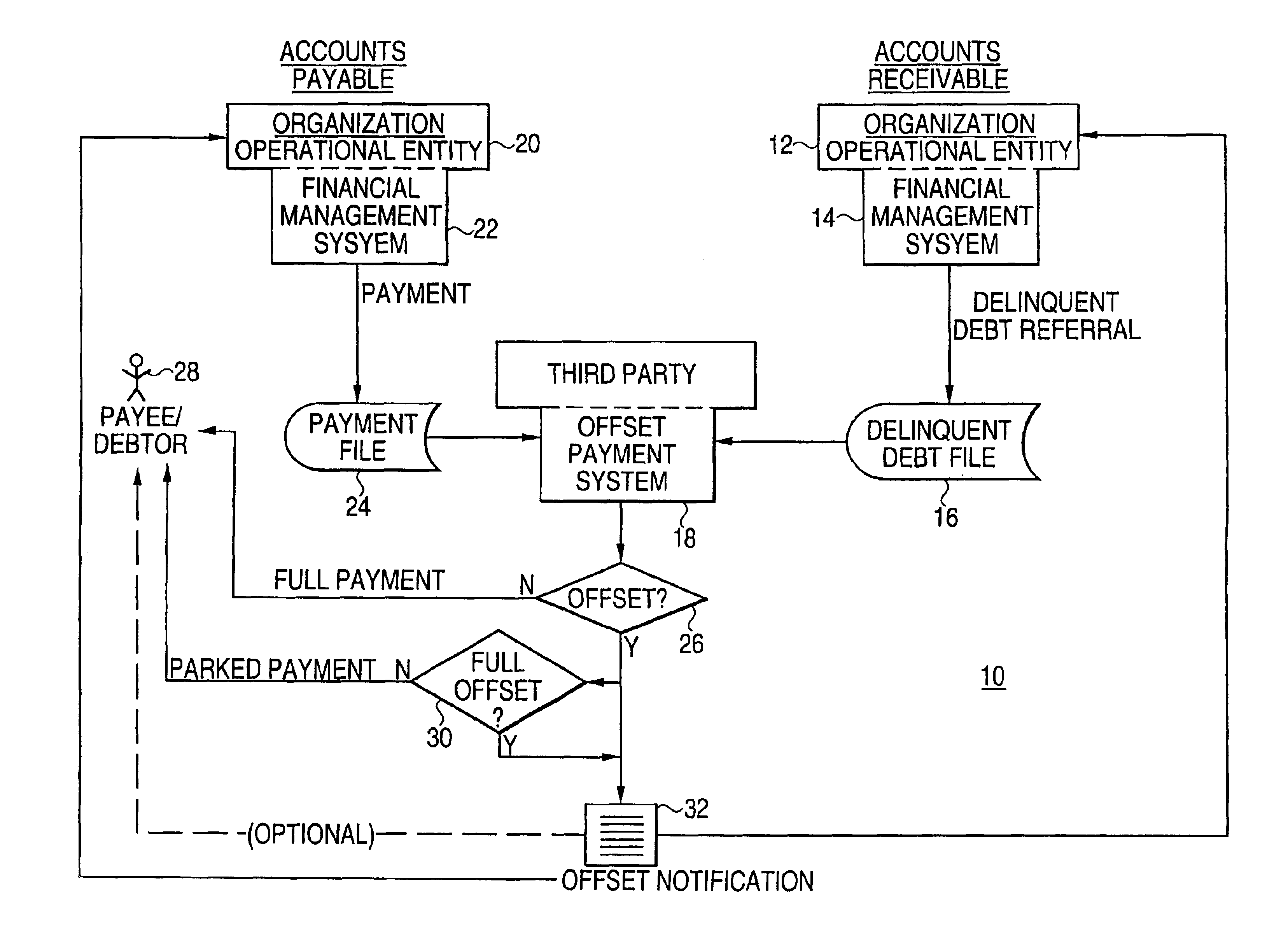

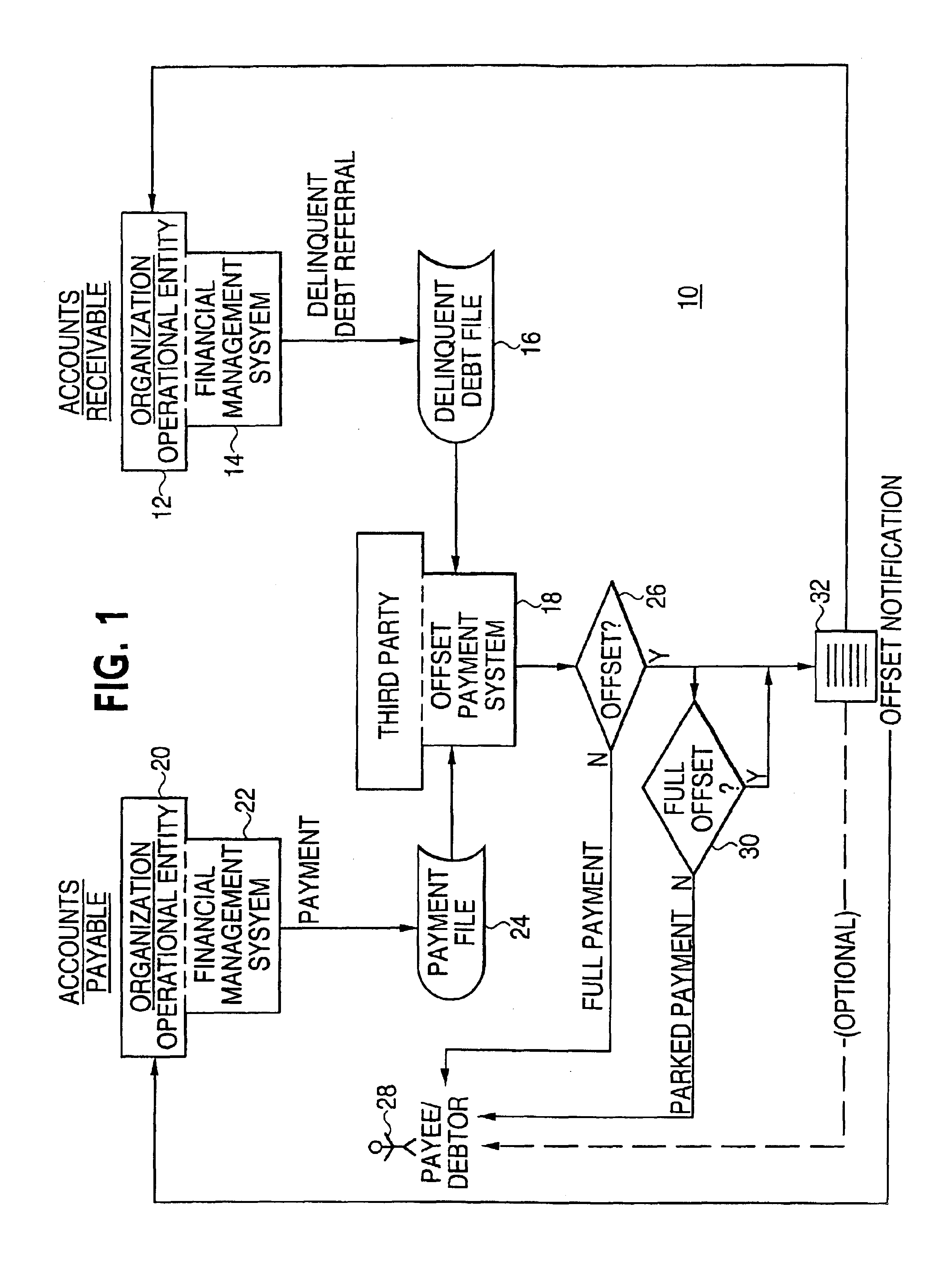

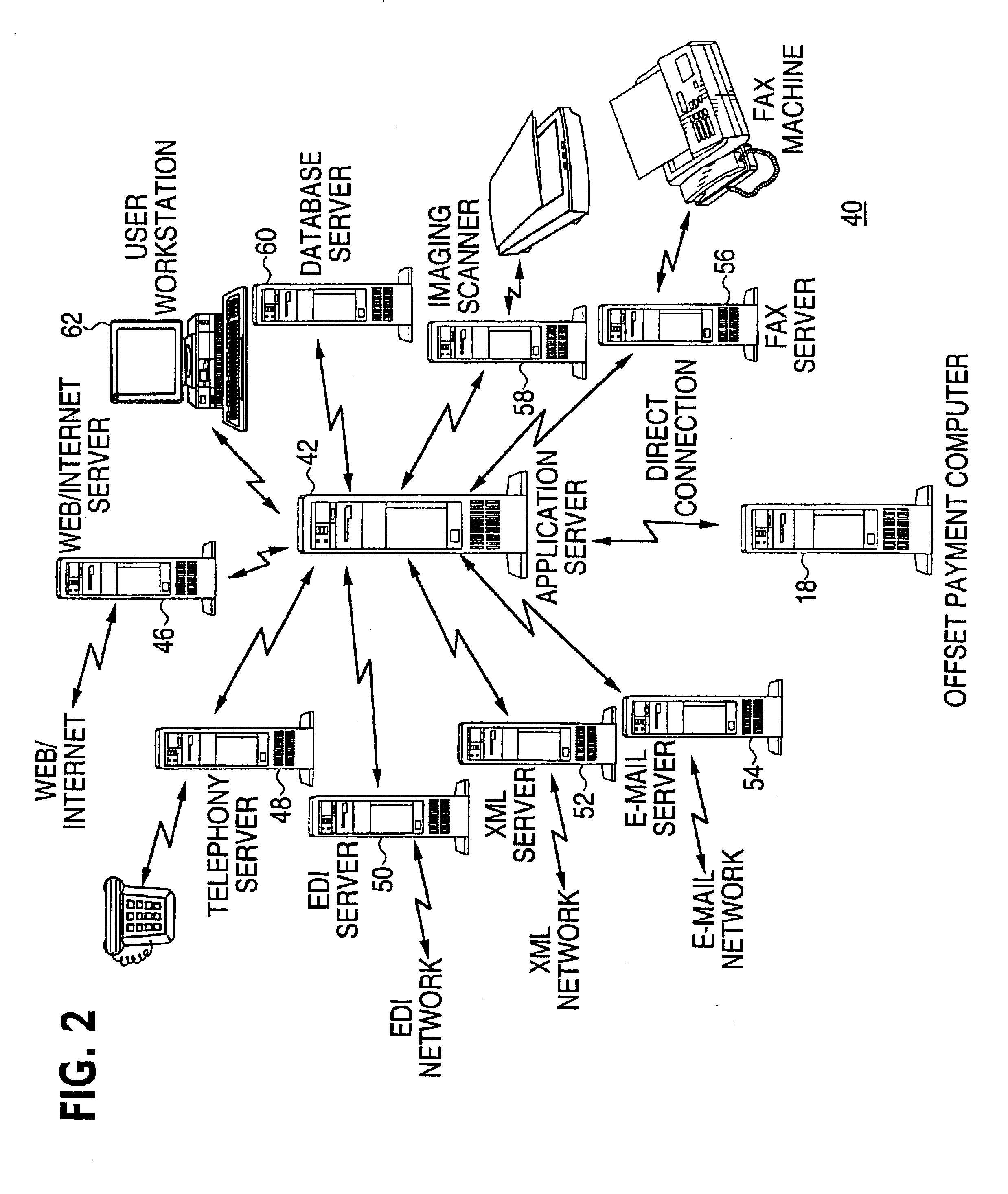

Financial management system including an offset payment process

The present invention is a system that includes a first financial management system handling receivables and a second financial management system handling payables. The receivables system sends debt offset information to an offset payment system and the payables system sends payment information to the offset payments system. The offset payment system either makes a payment or offsets the payment with the debt. Both of the financial management systems receive offset information from the offset payment system. The system designates, in the respective separate receivables and payables systems, debt and payments that are suitable for offset using threshold criteria such as age, amount, party, number of notices of delinquency, etc. The system allows administrative fees and other charges, such as interest and penalties, to be added to the debt as well as the limiting of the percentage applicable to the offset at the time of the referral. During the referral of the debt to the offset payments system, the debtor as well as other parties, such as credit bureaus, are informed or notified of the delinquent debt and the referral information can be stored in a data warehouse for later analysis.

Owner:CGI TECH & SOLUTIONS

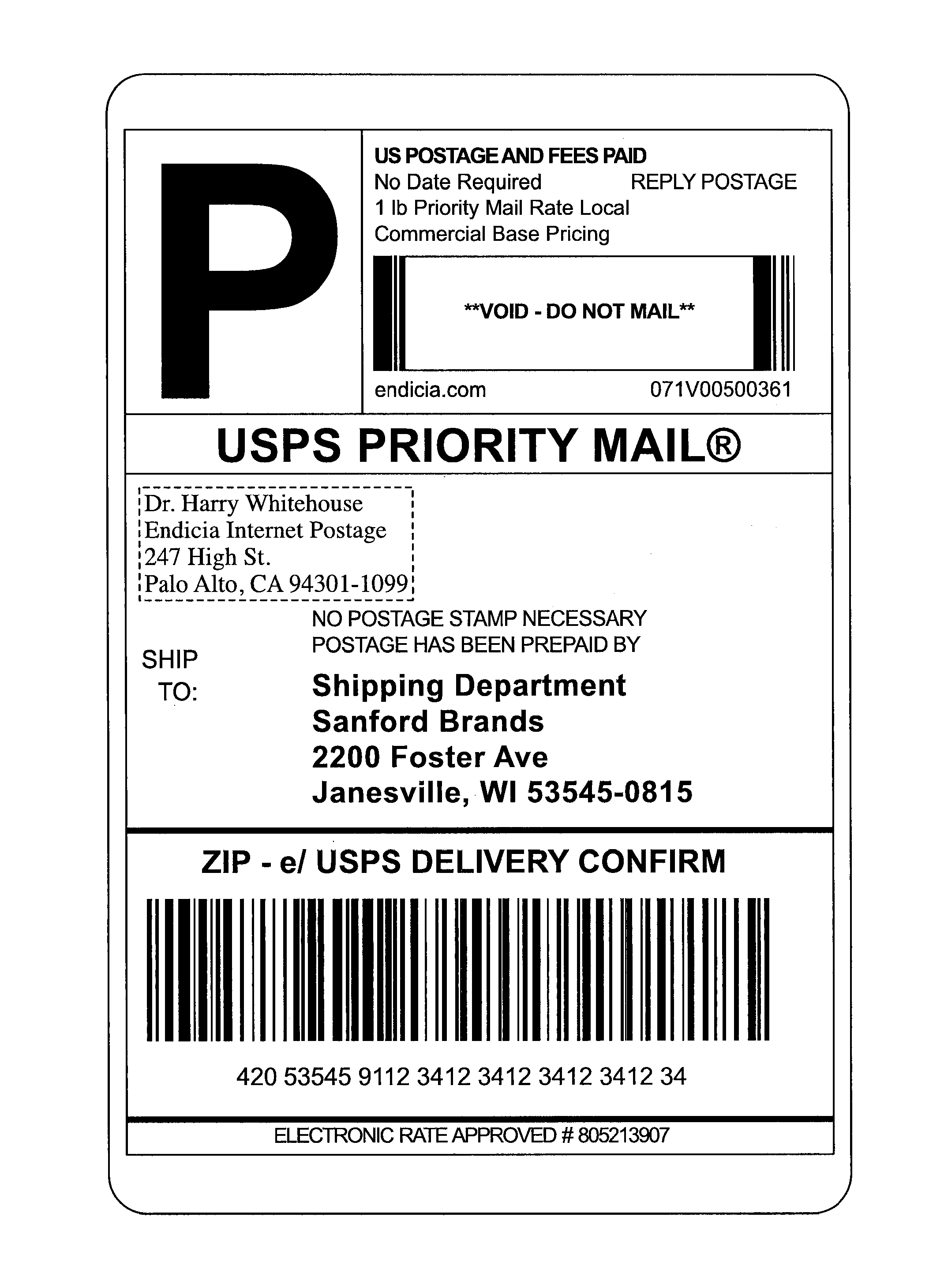

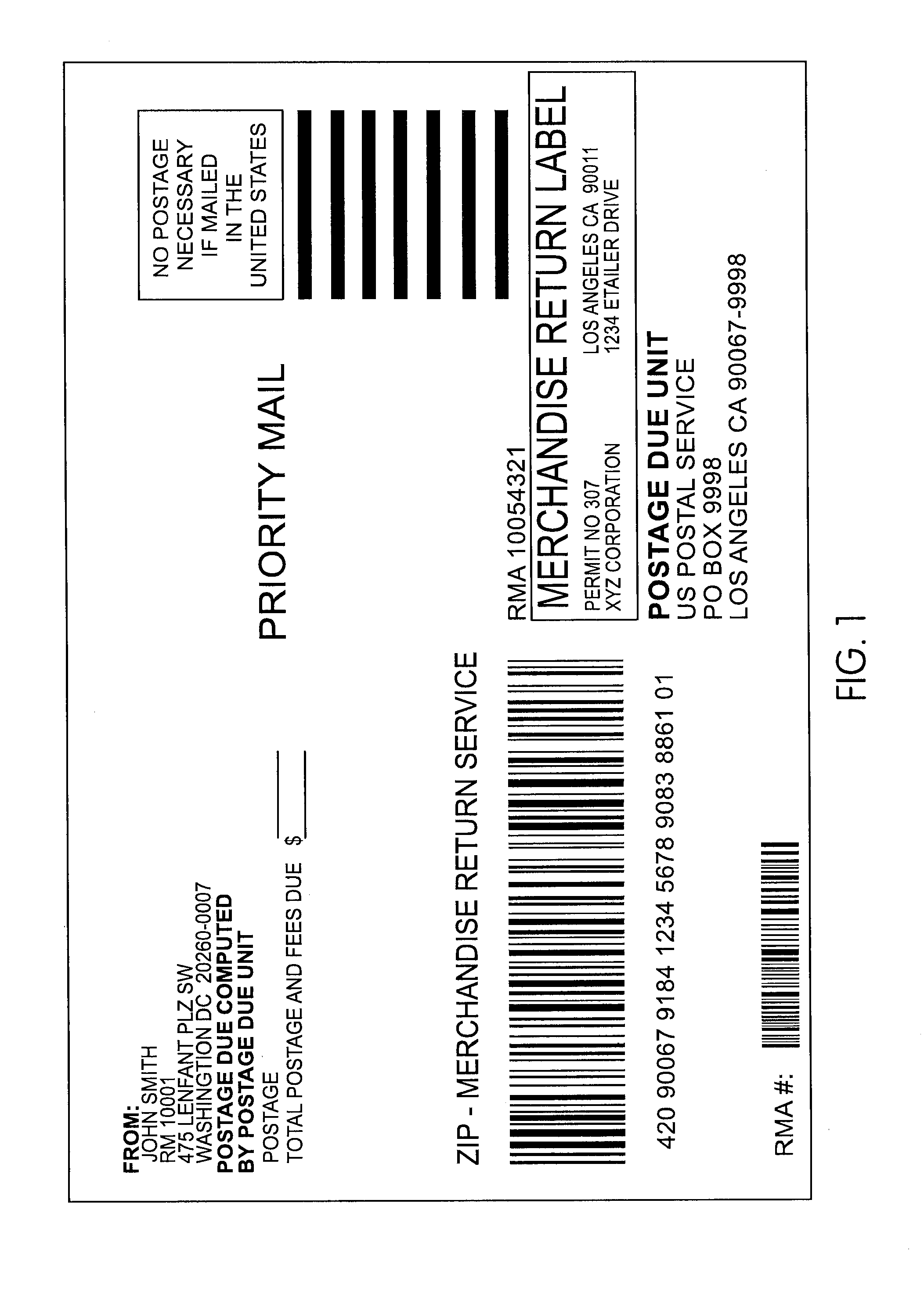

System and method for processing a mailing label

A system and method of processing a mailing label through a postal service that requires an account that can be charged for generating the mailing label are described. The method includes charging or deducting a fictitiously fundable or chargeable account to enable generation of a mailing label for a mail piece. The mailing label includes a tracking indicium associated with the fictitiously fundable or chargeable account. The method further includes receiving the tracking indicium scanned from the mailing label on the mail piece when the mail piece is inducted in the mail stream or during transit of the mail piece in the mail stream, and charging or deducting funds from an actually fundable or chargeable account based upon the received scanned tracking indicium.

Owner:PSI SYST

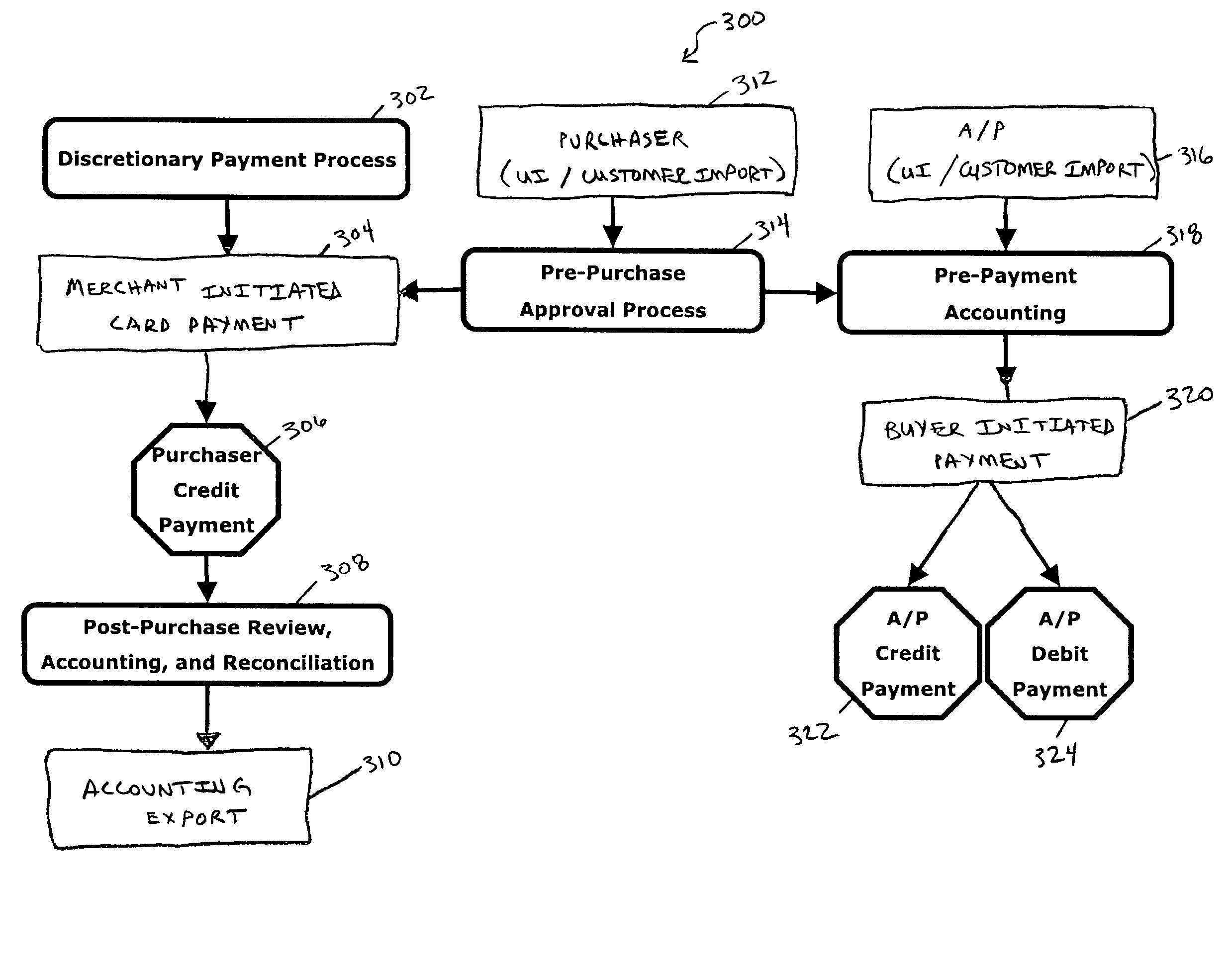

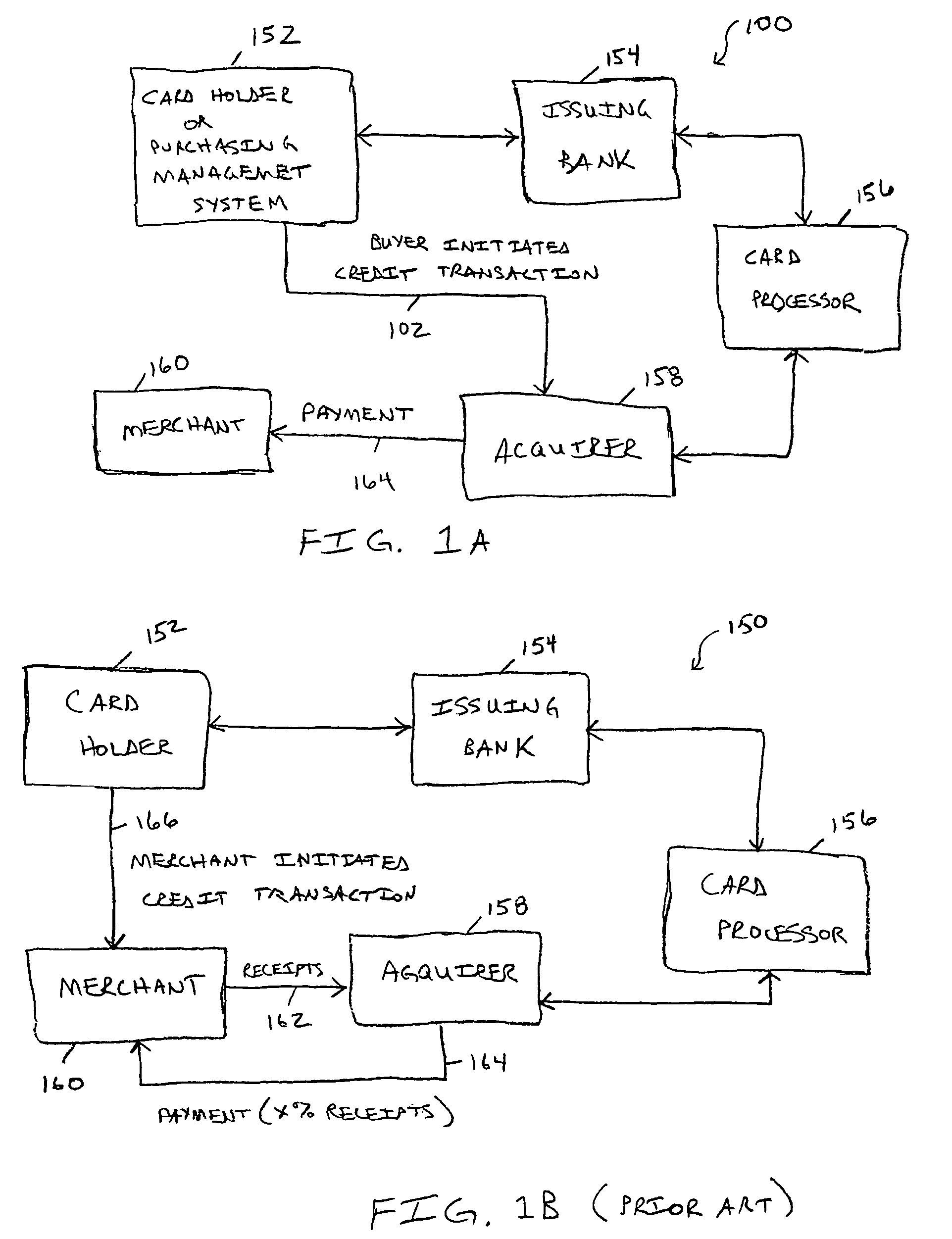

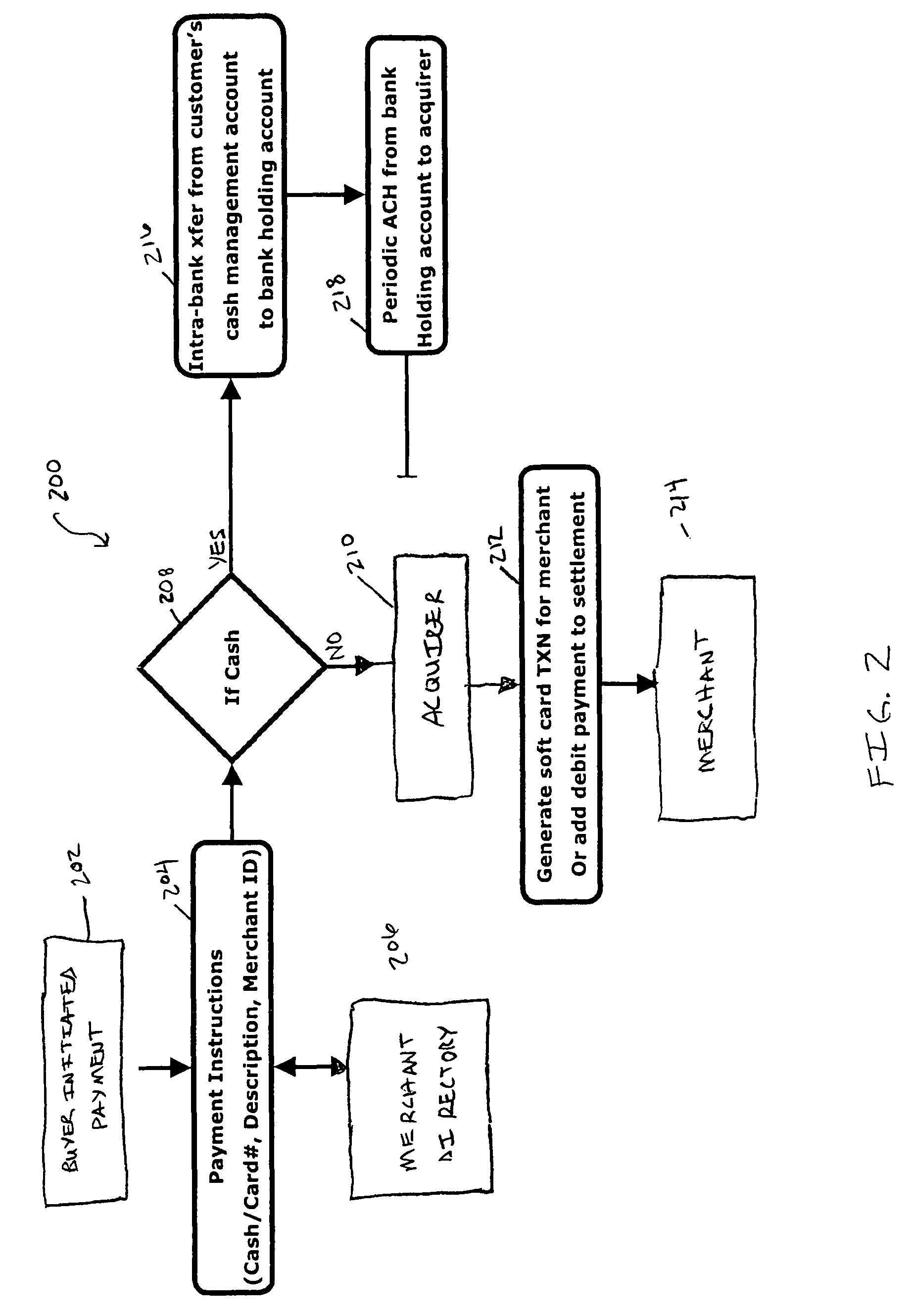

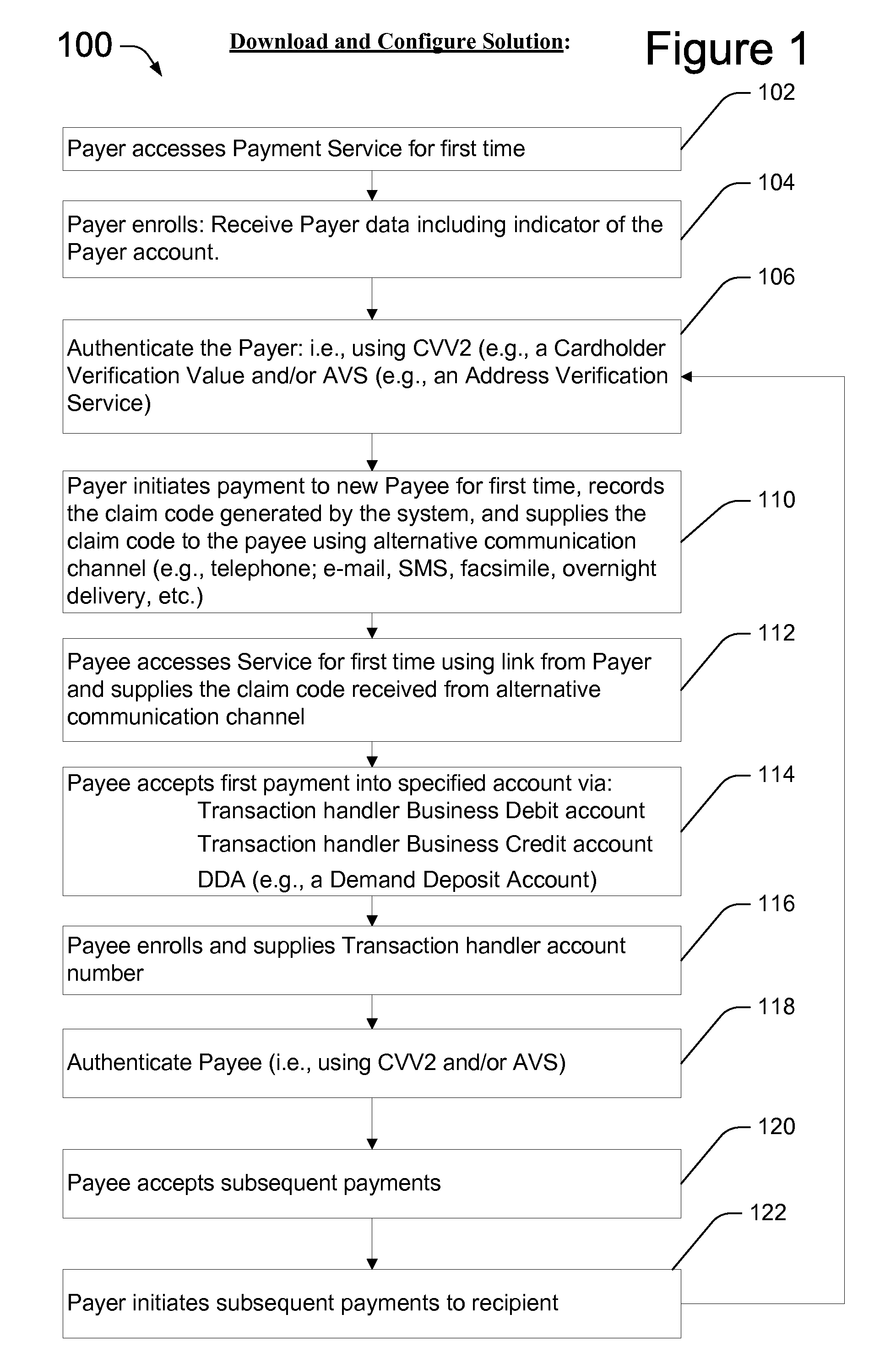

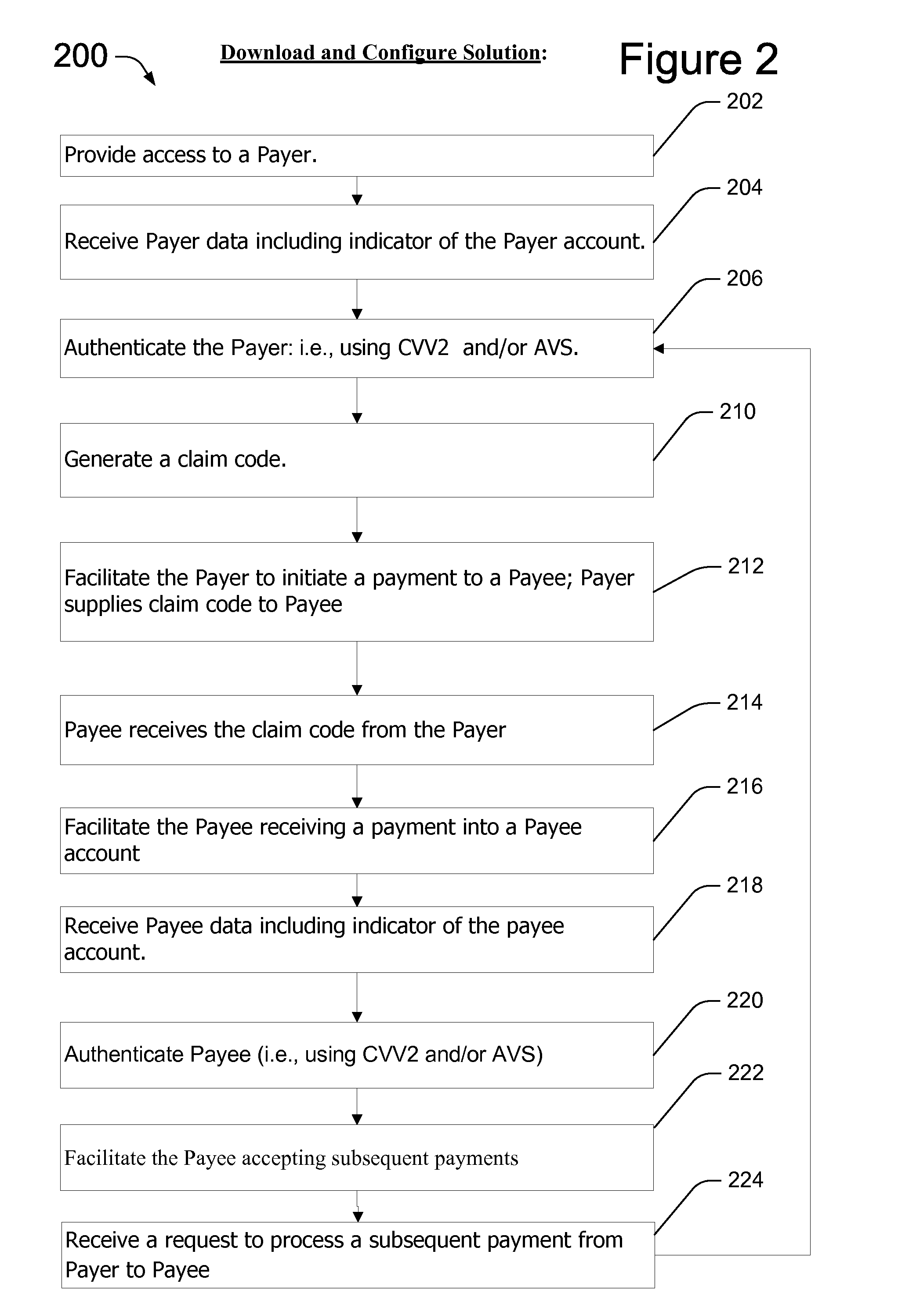

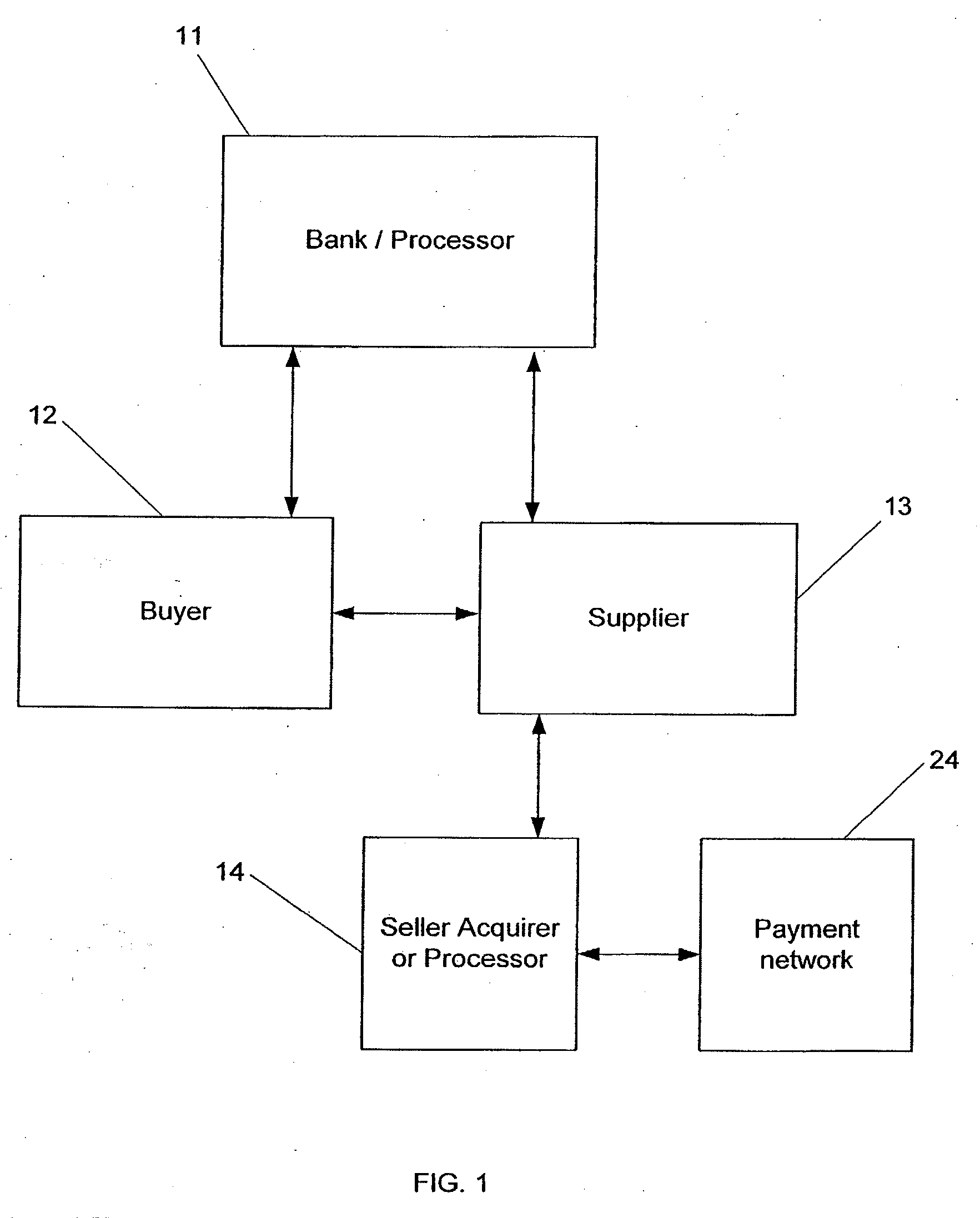

Method and system for pushing credit payments as buyer initiated transactions

ActiveUS7895119B2Advantageous and efficient and powerful solutionFinanceAnonymous user systemsCredit cardStrong solutions

A method and system are disclosed for pushing credit payments as buyer initiated transactions. The buyer communicates payment instructions to initiate payment of accounts payable items so that the existing credit card infrastructure can be used to make payments to merchants without a credit card transaction being initiated by the merchants. In this way, a buyer can push credit payments into the system without having to communicate with the merchant, and these transactions can be processed as credit transactions with respect to standard settlement procedures, for example, as used by credit card receipt acquirers. This ability to push credit payments provides an advantageous, efficient and powerful solution to handling accounts payable operations, particularly in a corporate environment. And a purchasing management system can be used to manage and control these activities and to allow selection, or automatic selection based upon merchant profiles, of whether to make payments as pushed credit payments or cash / debit transactions.

Owner:BANK OF AMERICA CORP

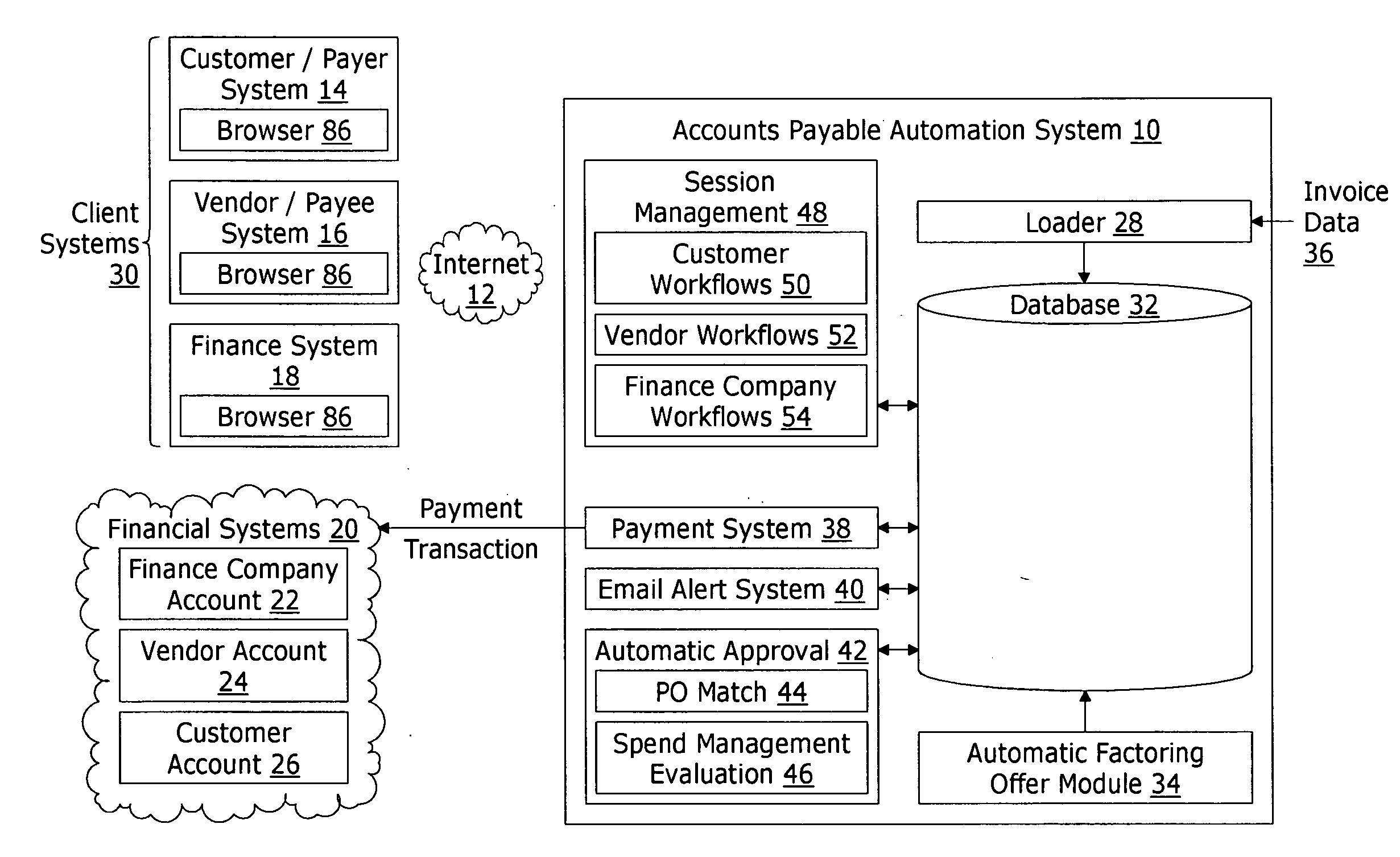

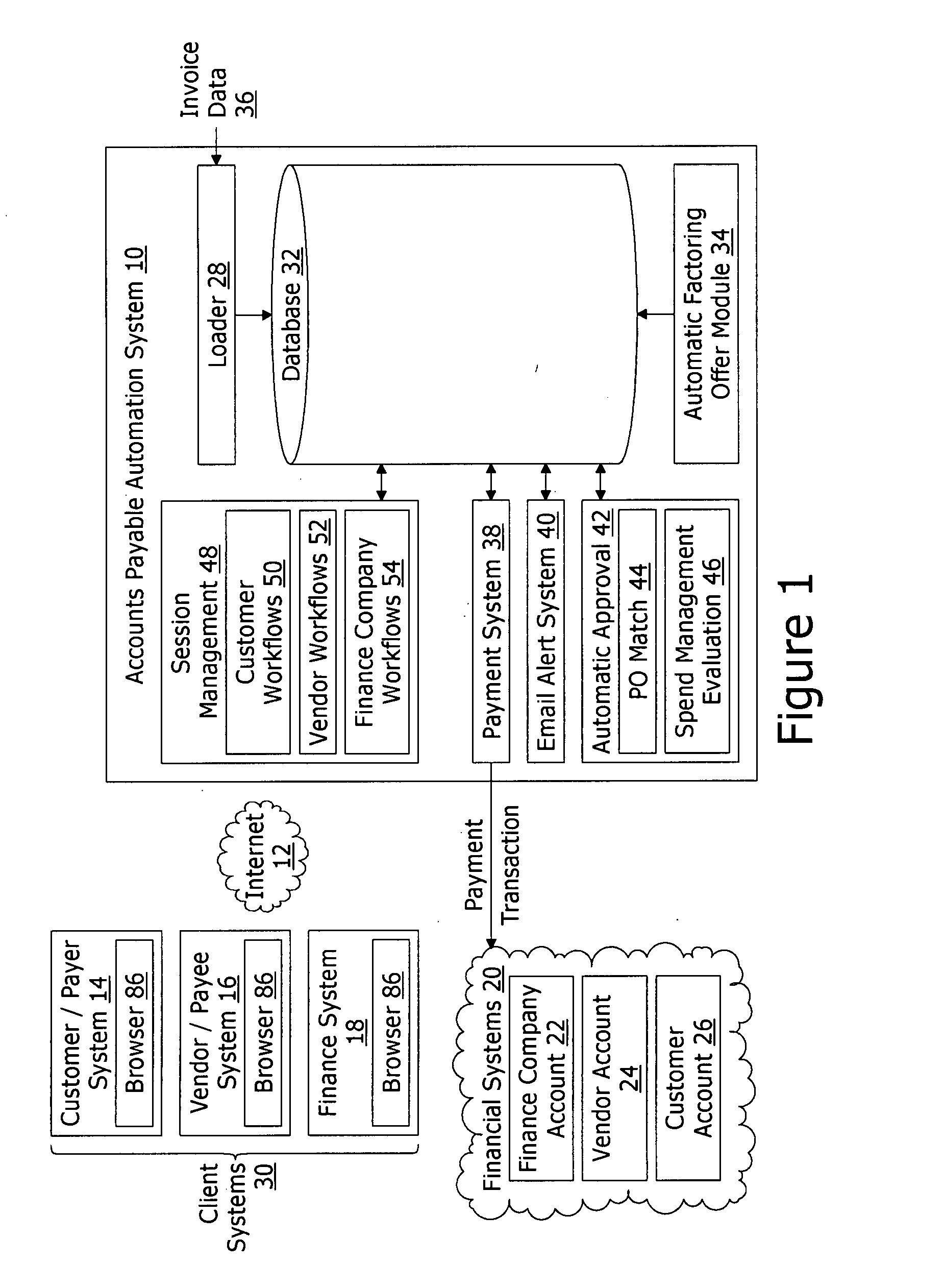

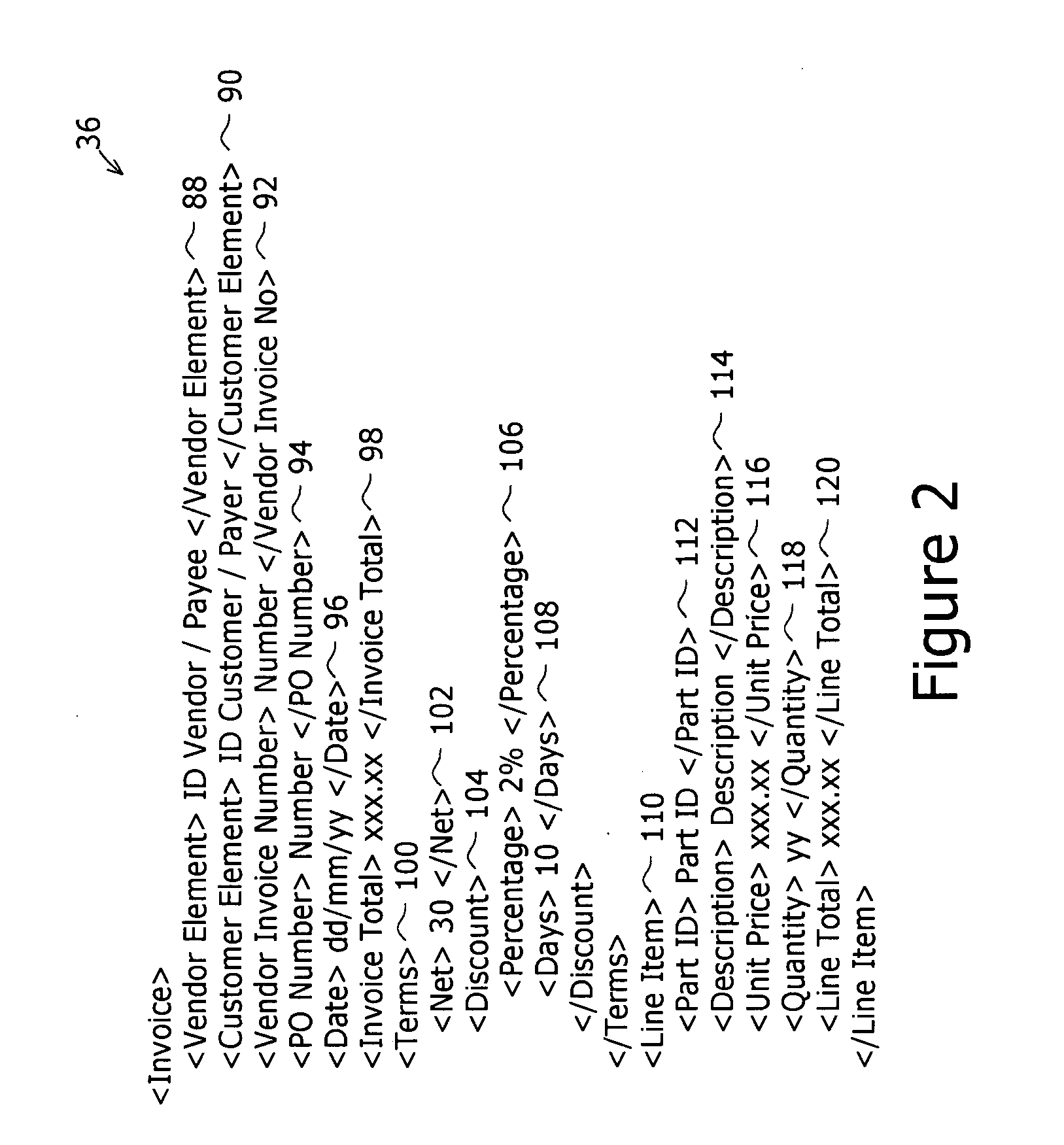

Accounts payable automation system with automated discount and factoring management

An accounts payable automation server system with integrated discount and factoring management, the system comprises an invoice loader receiving invoice data. The invoice data includes at least a vendor element and an amount payable element. The vendor element identifies a vendor and the amount payable element identifies consideration payable by the customer to the vendor. Customer user access workflows present, to a customer system, the invoice data. Finance company user access workflows: i) present, to a finance system, the vendor element and the amount payable element; and ii) receive, from the finance system, an offer of early payment in exchange for a discount of the consideration payable. Vendor user access workflows: i) present, to the vendor system, the offer of early payment in exchange for a discount of the consideration payable; and ii) receive an acceptance of the offer from the vendor system. The finance company user access workflows further, upon acceptance of the offer, present, to the finance system, an indication of the acceptance of the offer. Further, upon payment of a discounted amount from the finance company to the vendor, a direction to transfer payment of the consideration to the finance company is recorded.

Owner:BOTTOMLINE TECH

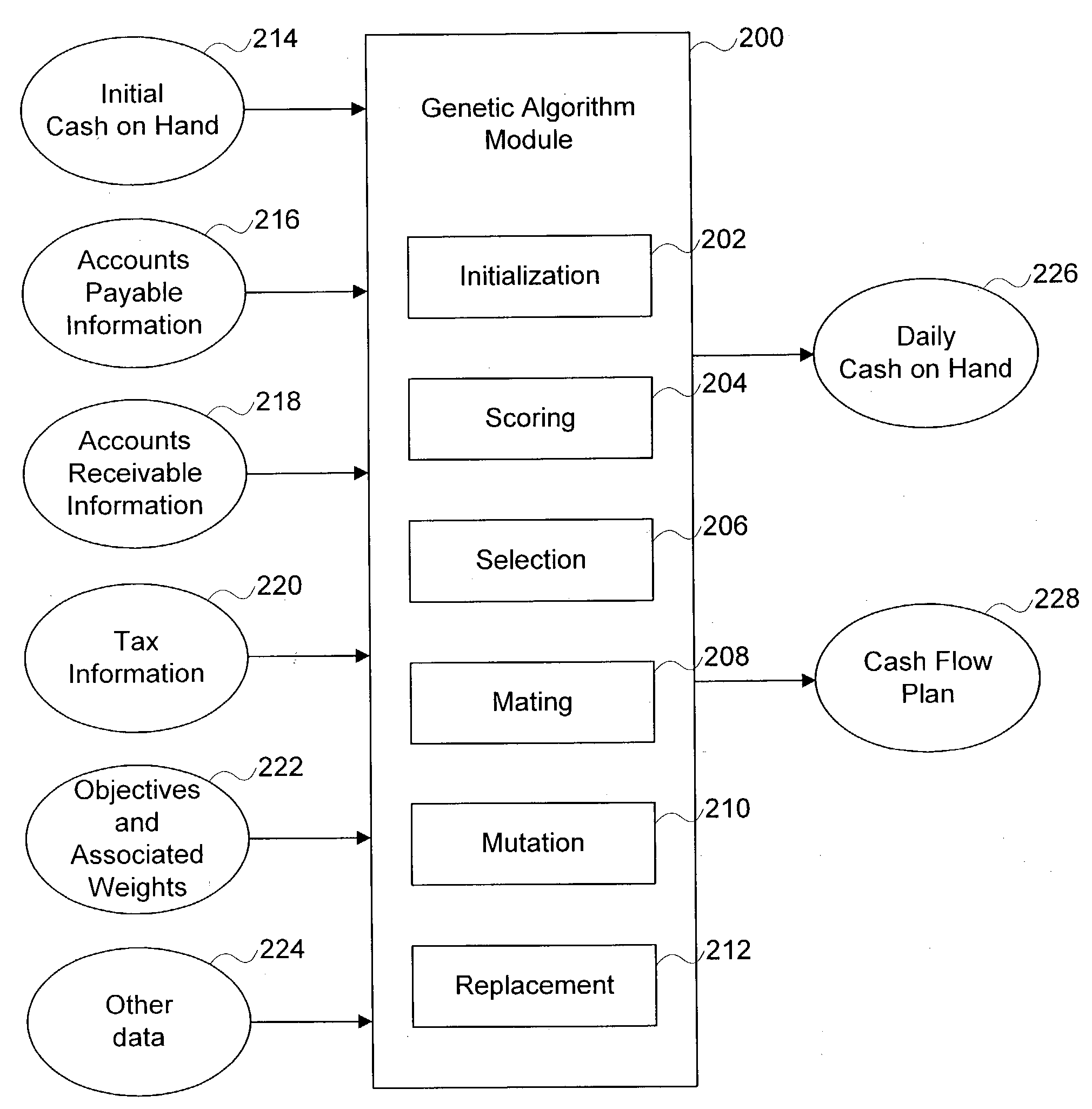

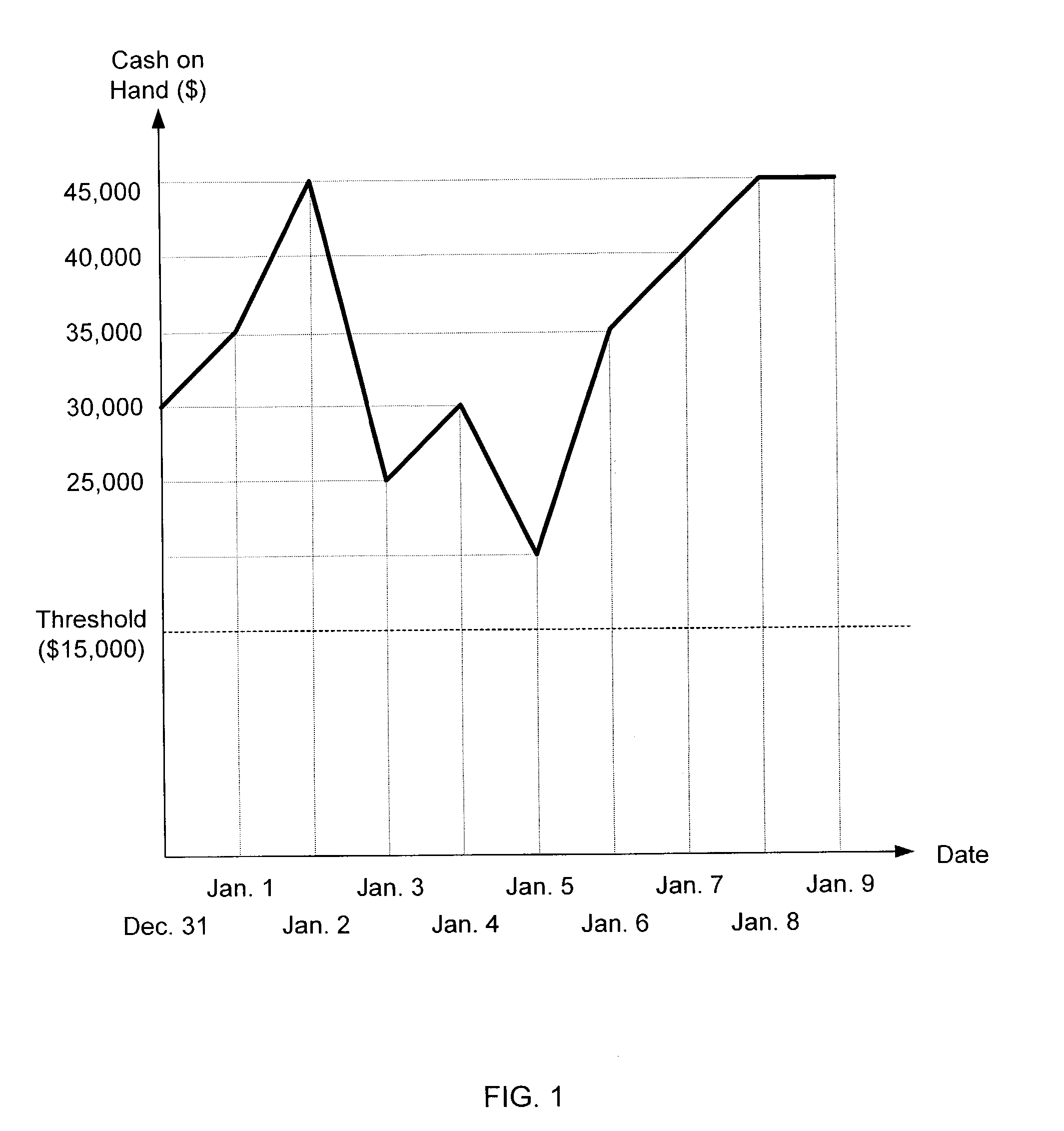

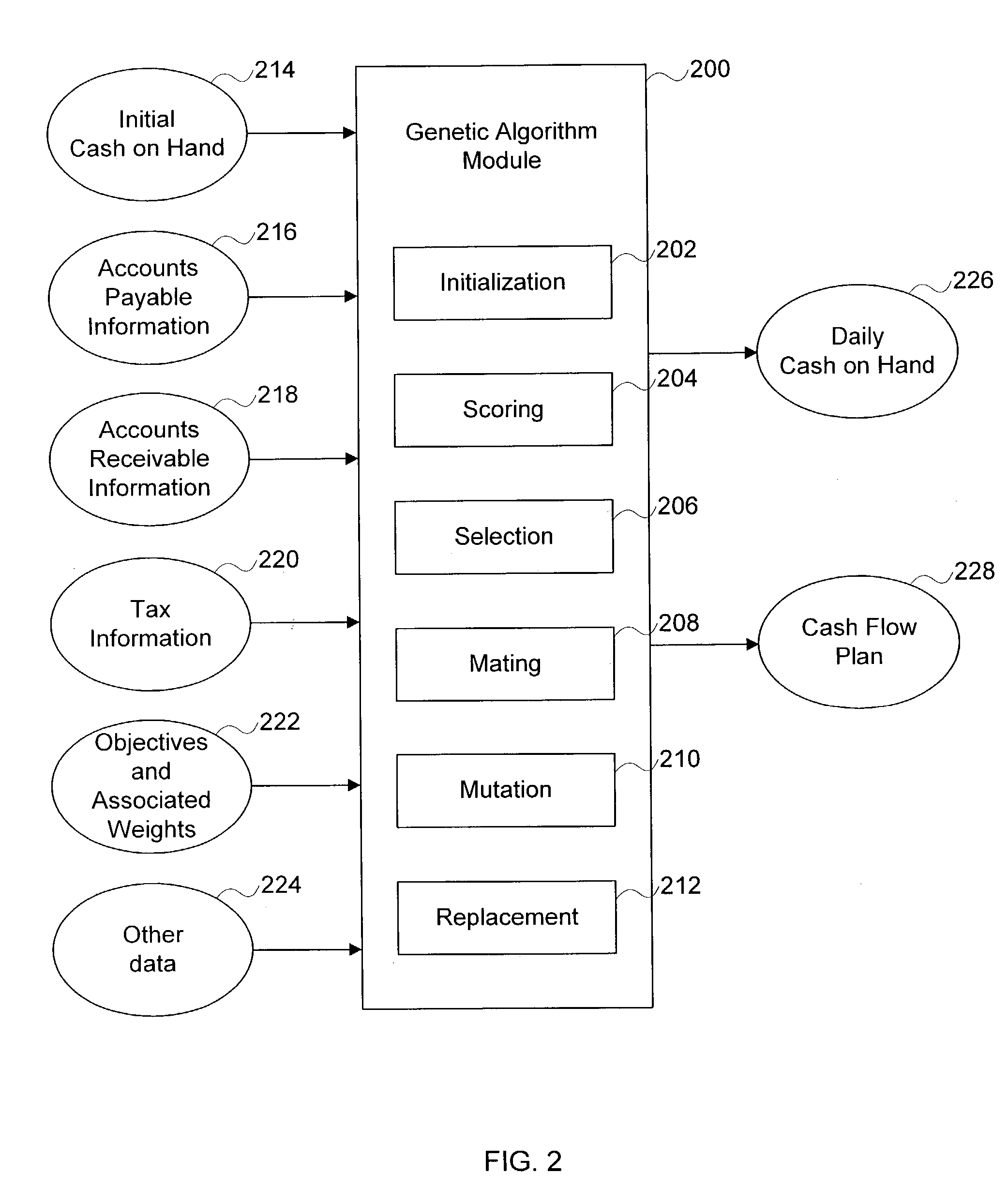

Cash flow optimization using a genetic algorithm

InactiveUS7124105B2Maximizing the minimum daily cash on handMinimizing late payment feesFinanceForecastingAccounts payableGenetic algorithm optimization

Owner:INTUIT INC

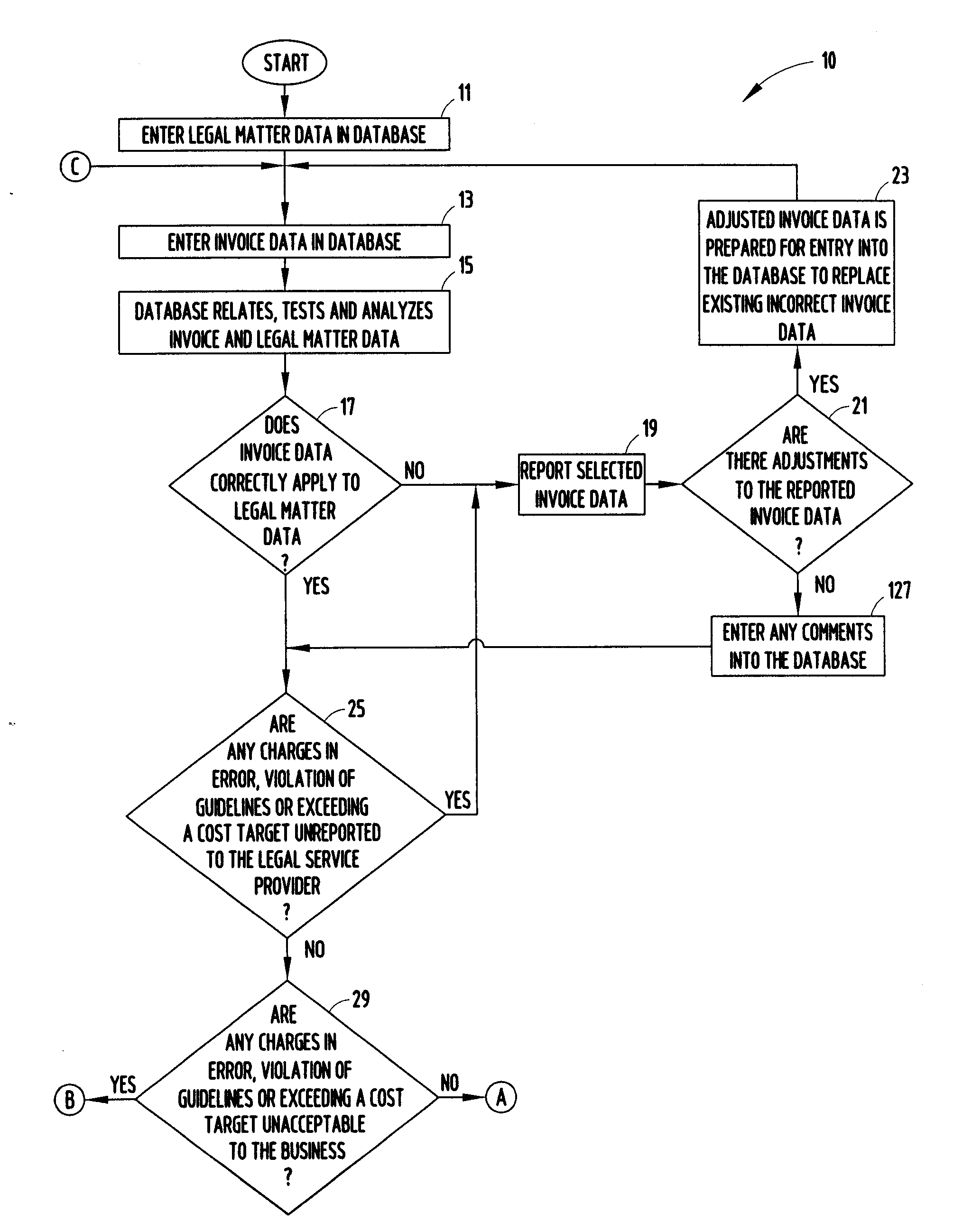

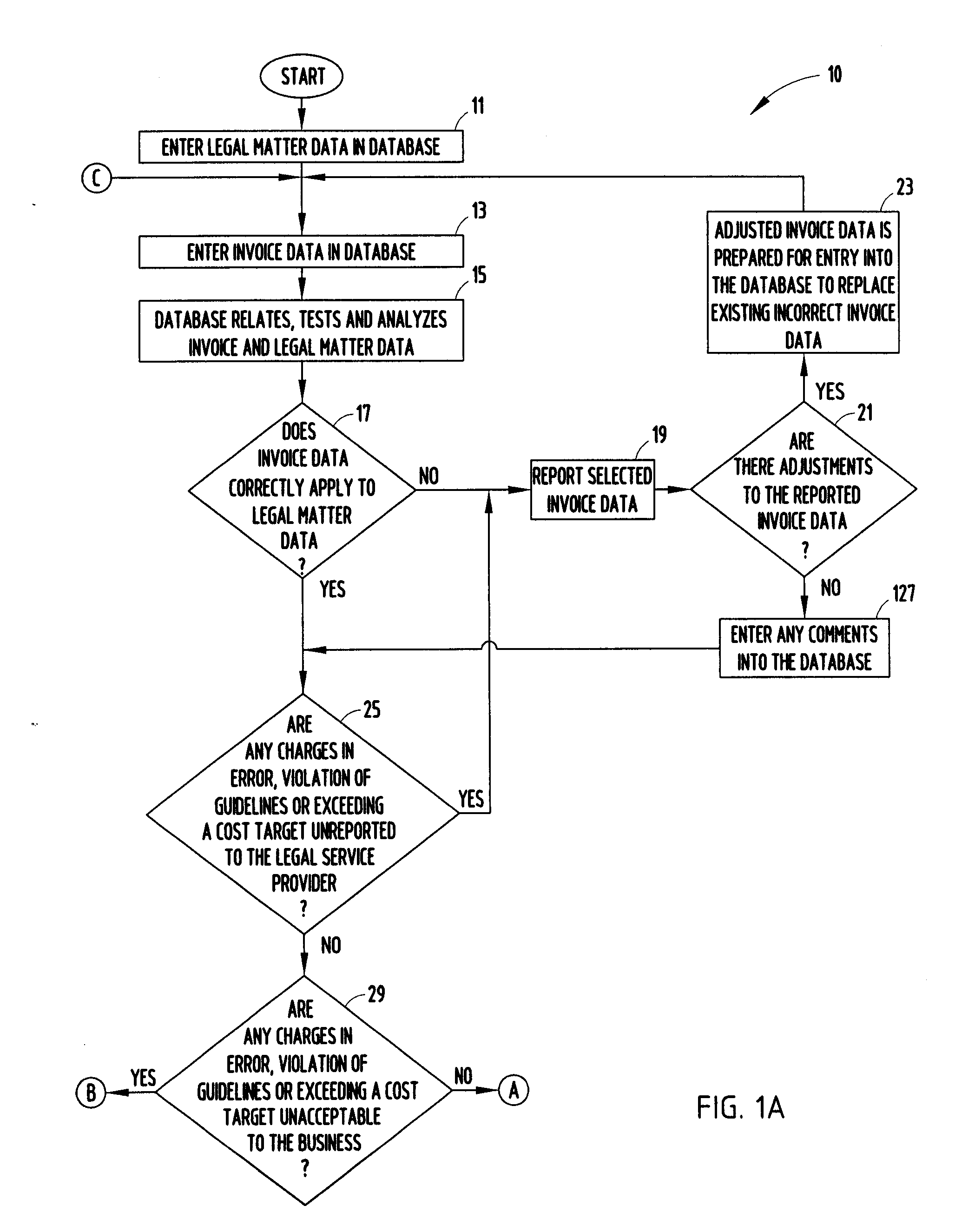

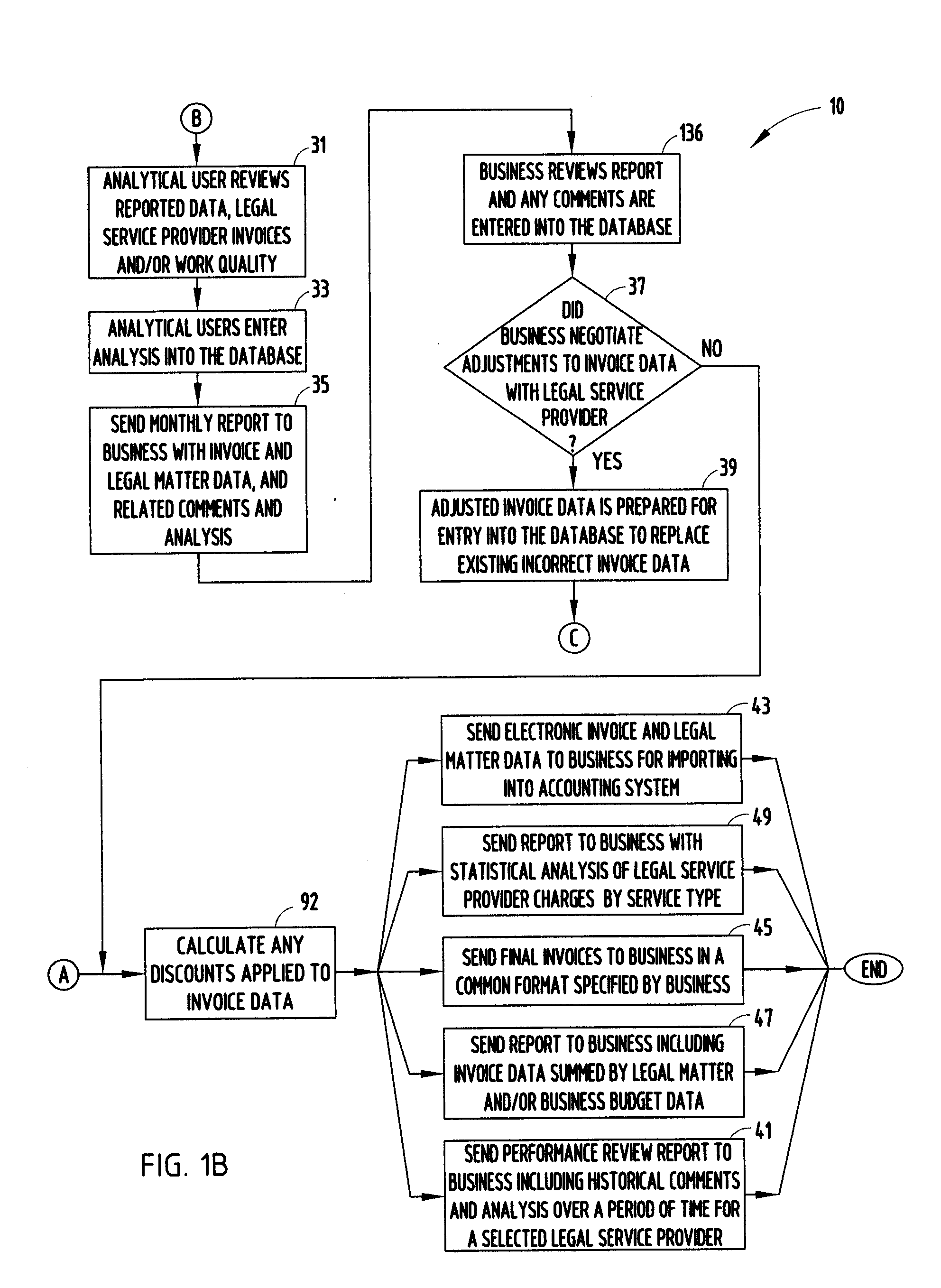

Method and system for managing legal matters

InactiveUS20090037247A1Precise managementQuick reviewComplete banking machinesFinanceService provisionAccounts payable

This invention generally relates to a system and method for managing legal services as well as legal matters, assets, expenses and / or invoices and more particularly relates to a computer assisted system that stores, organizes and / or performs operations on data relating to legal services, legal matters, assets, costs, invoices and the like allowing a user of the system to search, sort, report, track, docket, sum, average and / or perform other operations on this data to generate legal service performance review reports, invoice review reports and / or various expense reports as well as calculate accounts payable, calculate inter-company charges and / or otherwise may manage the same by identifying internal and legal service provider inefficiencies and by identifying unnecessary and excessively priced services and expenses.

Owner:ITIP DEV

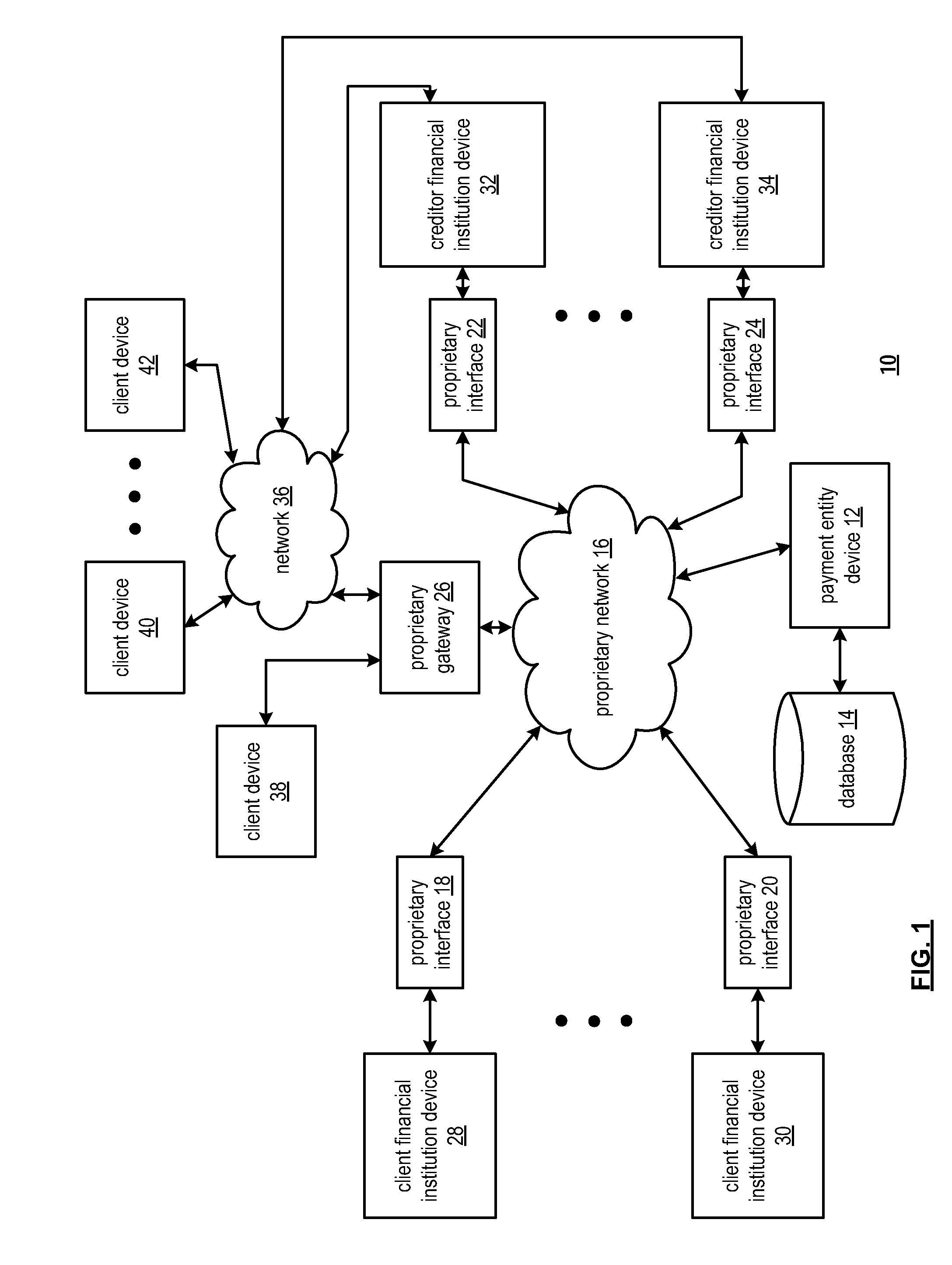

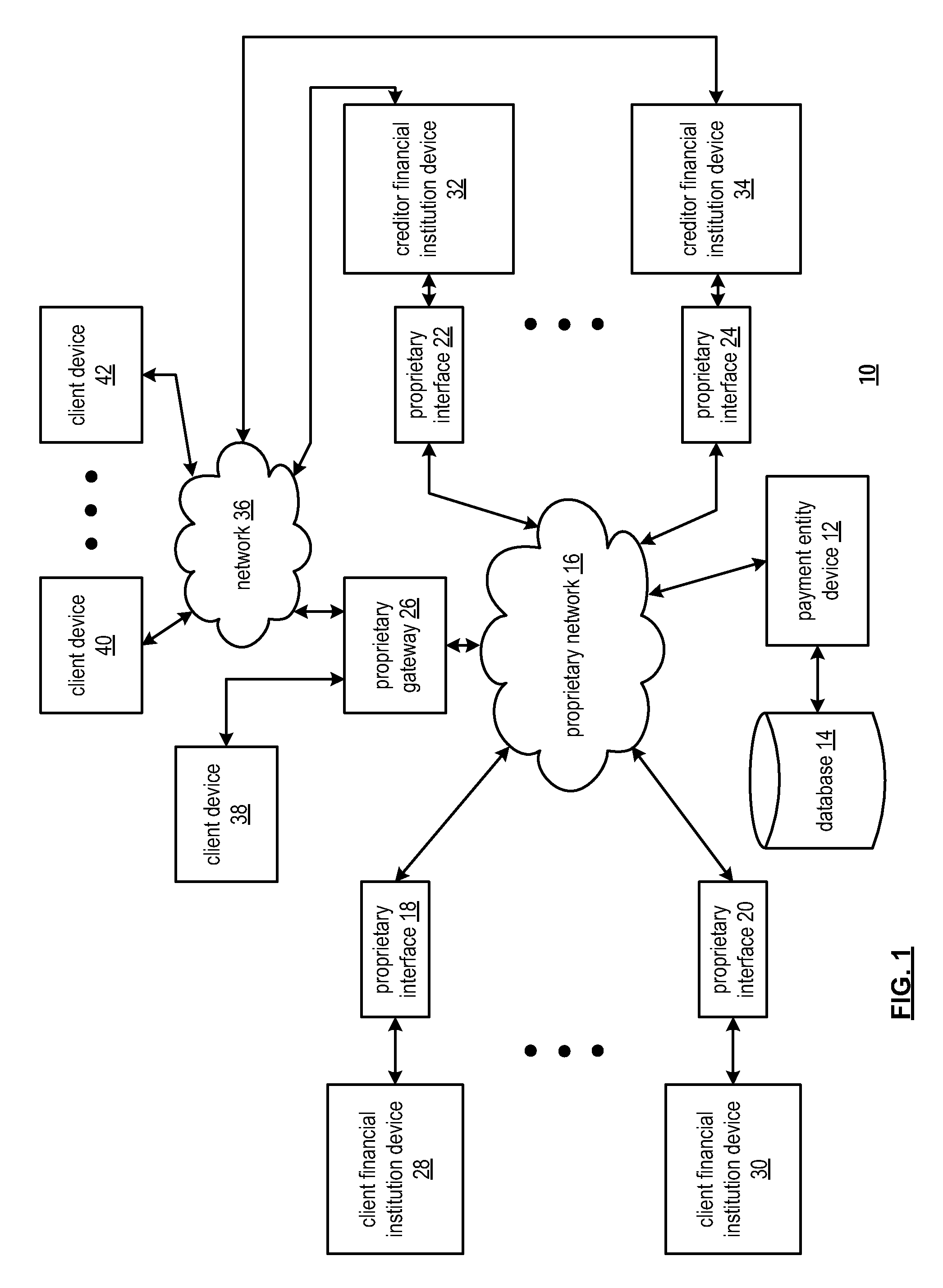

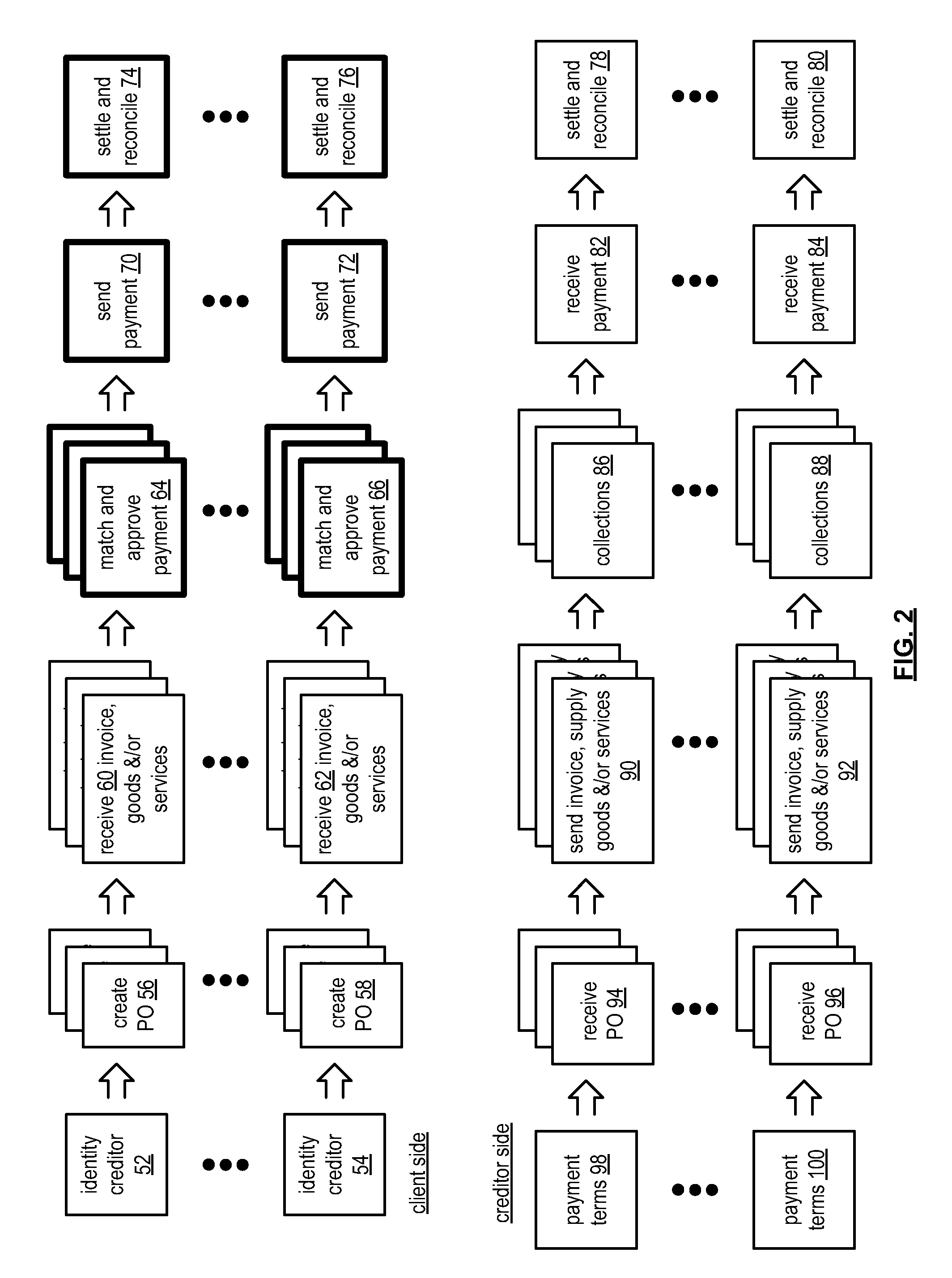

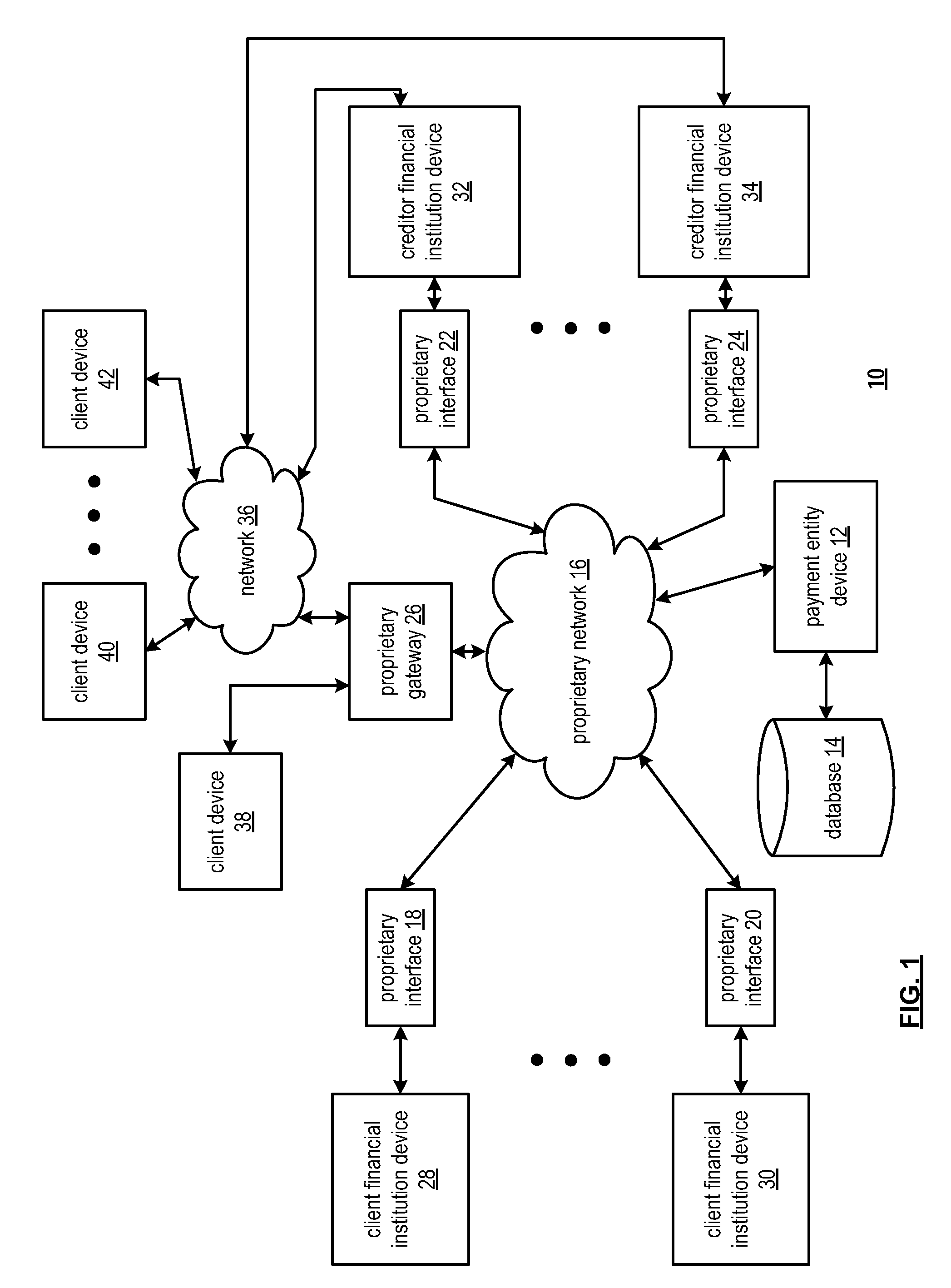

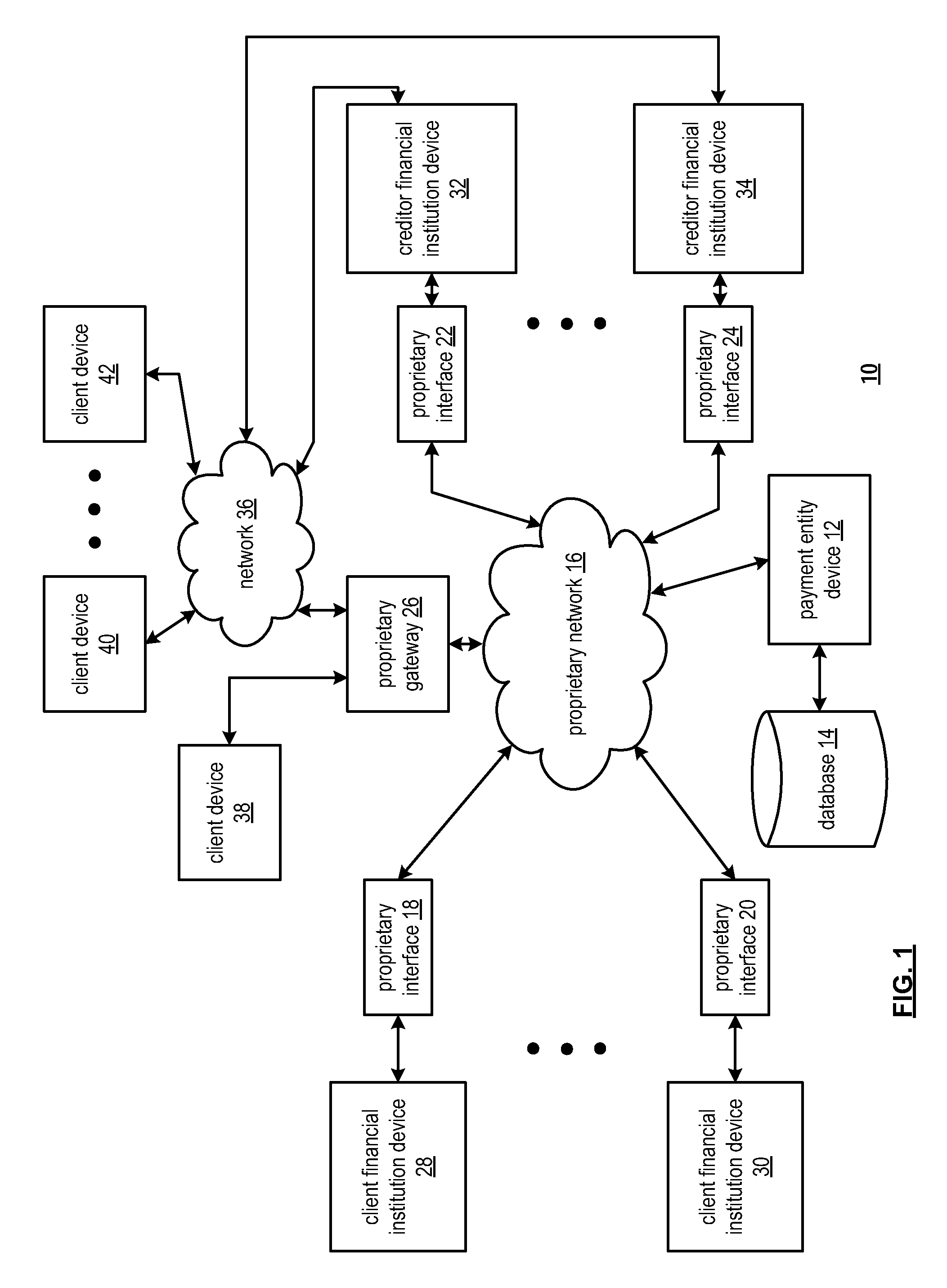

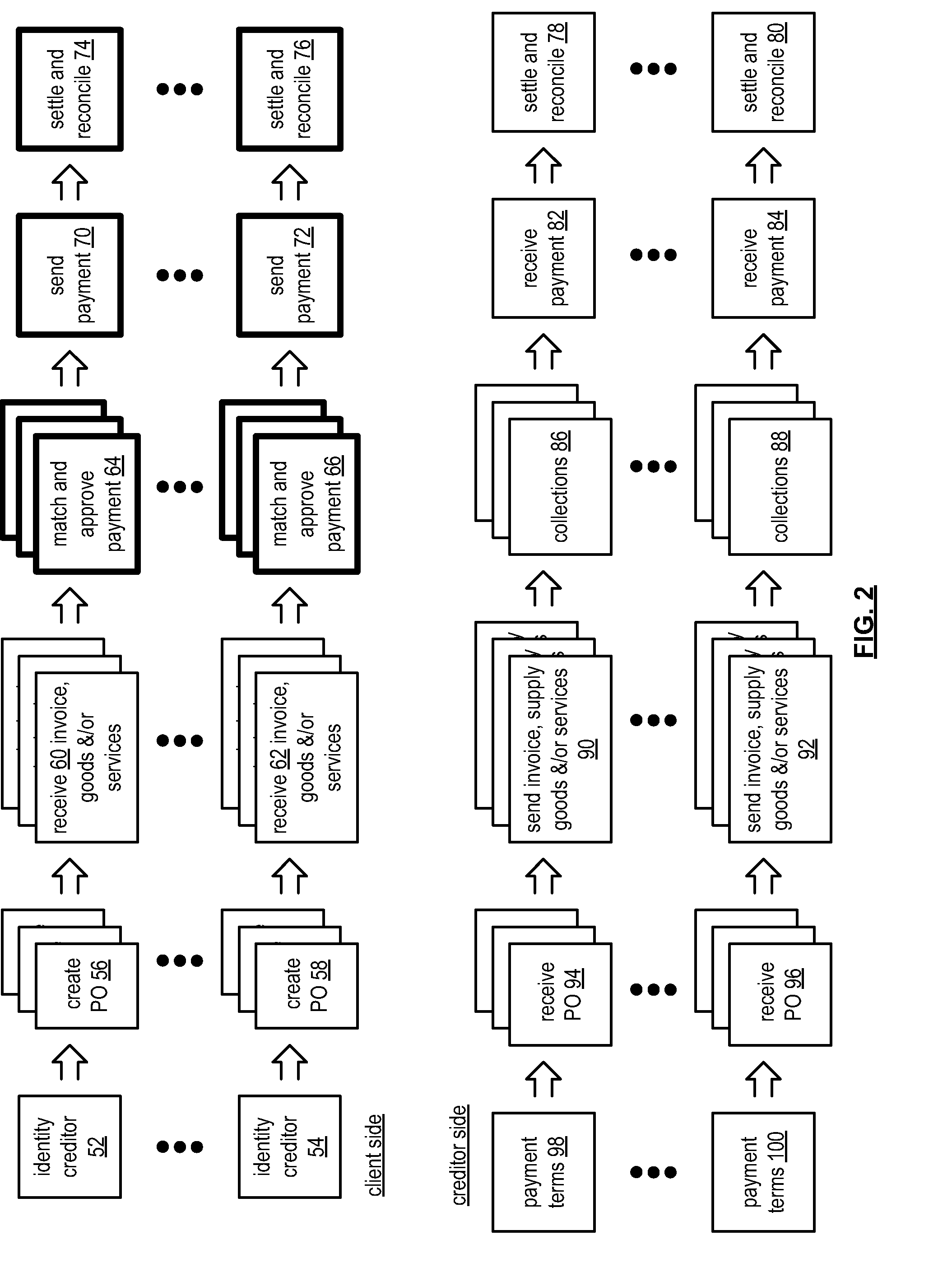

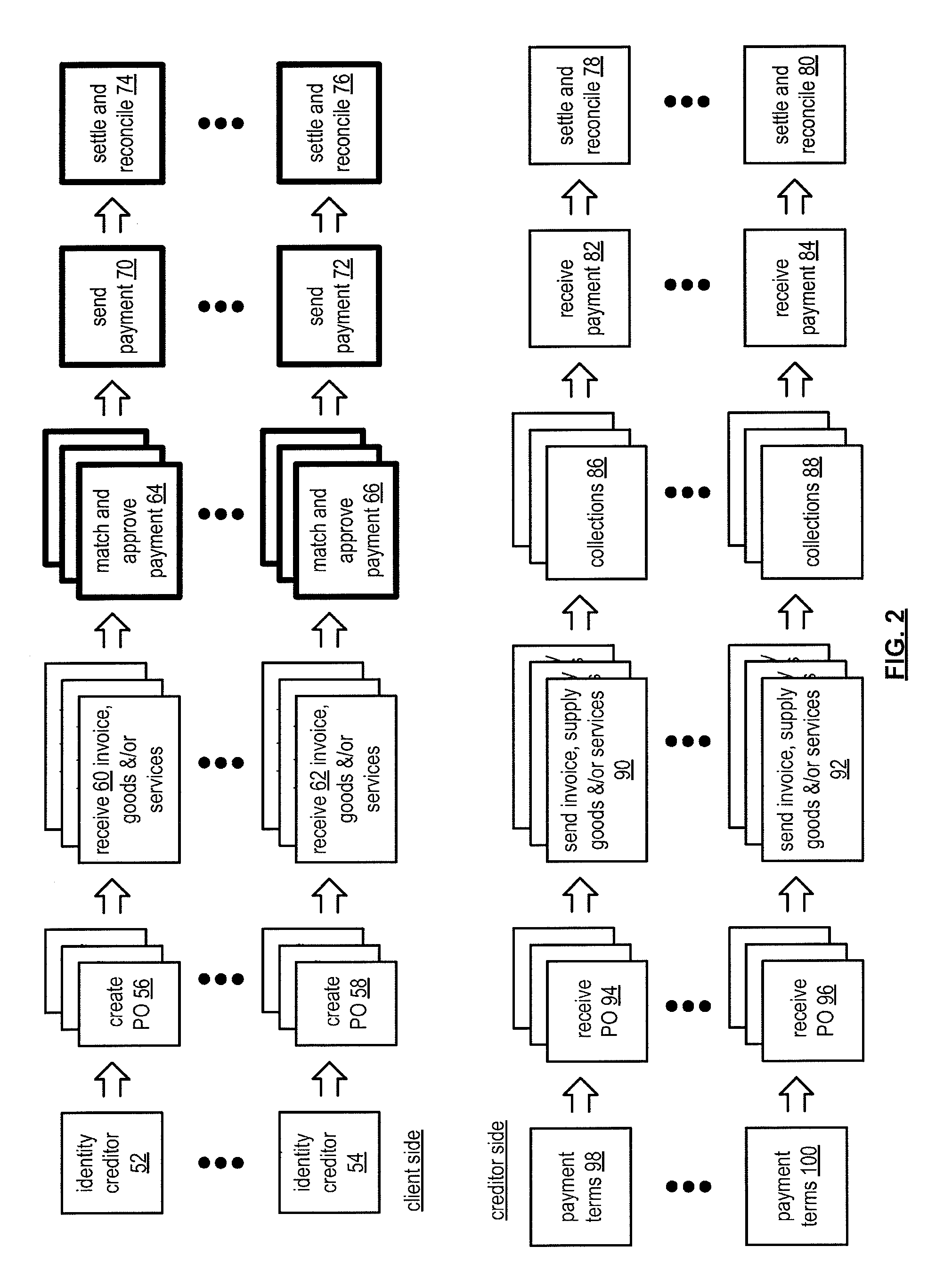

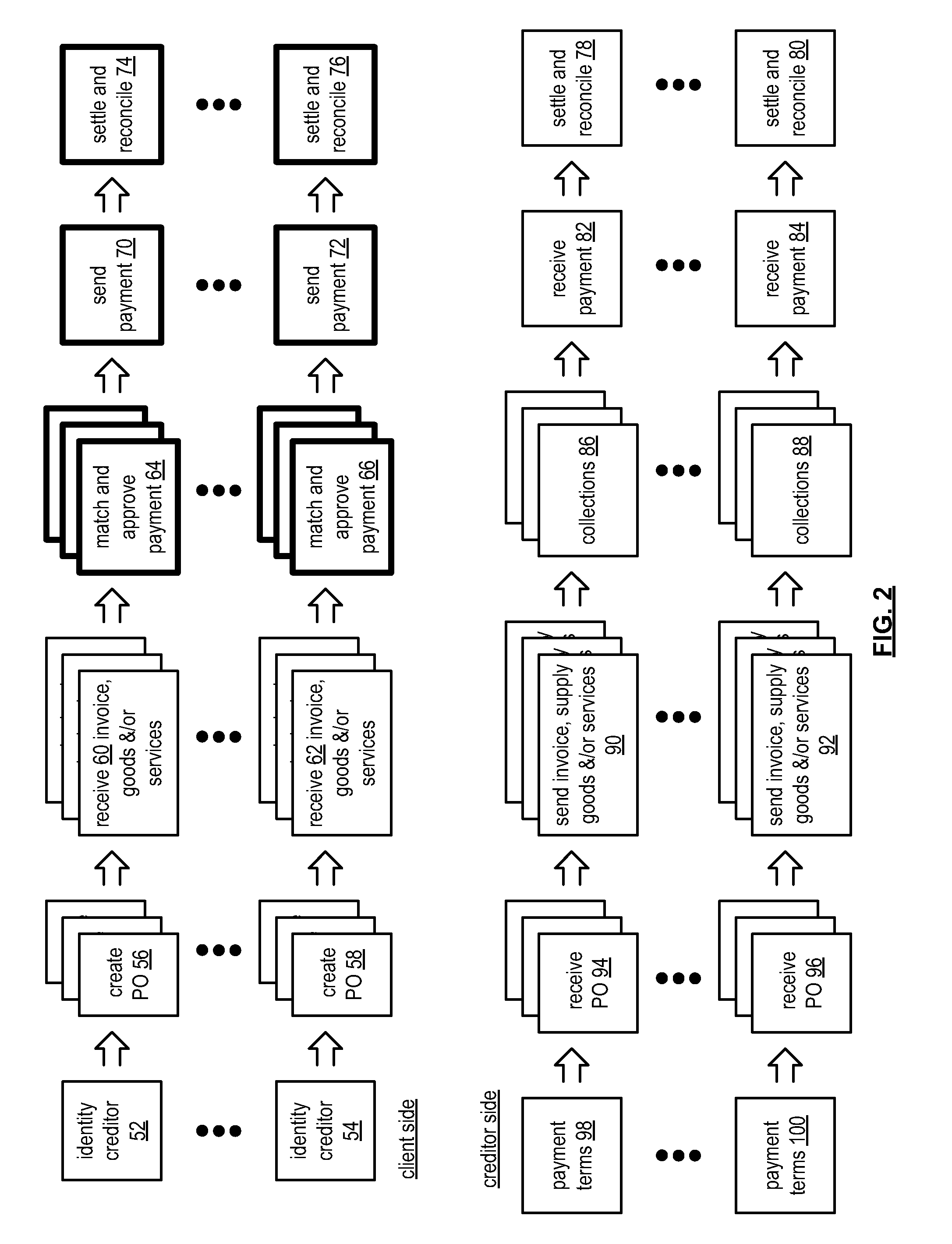

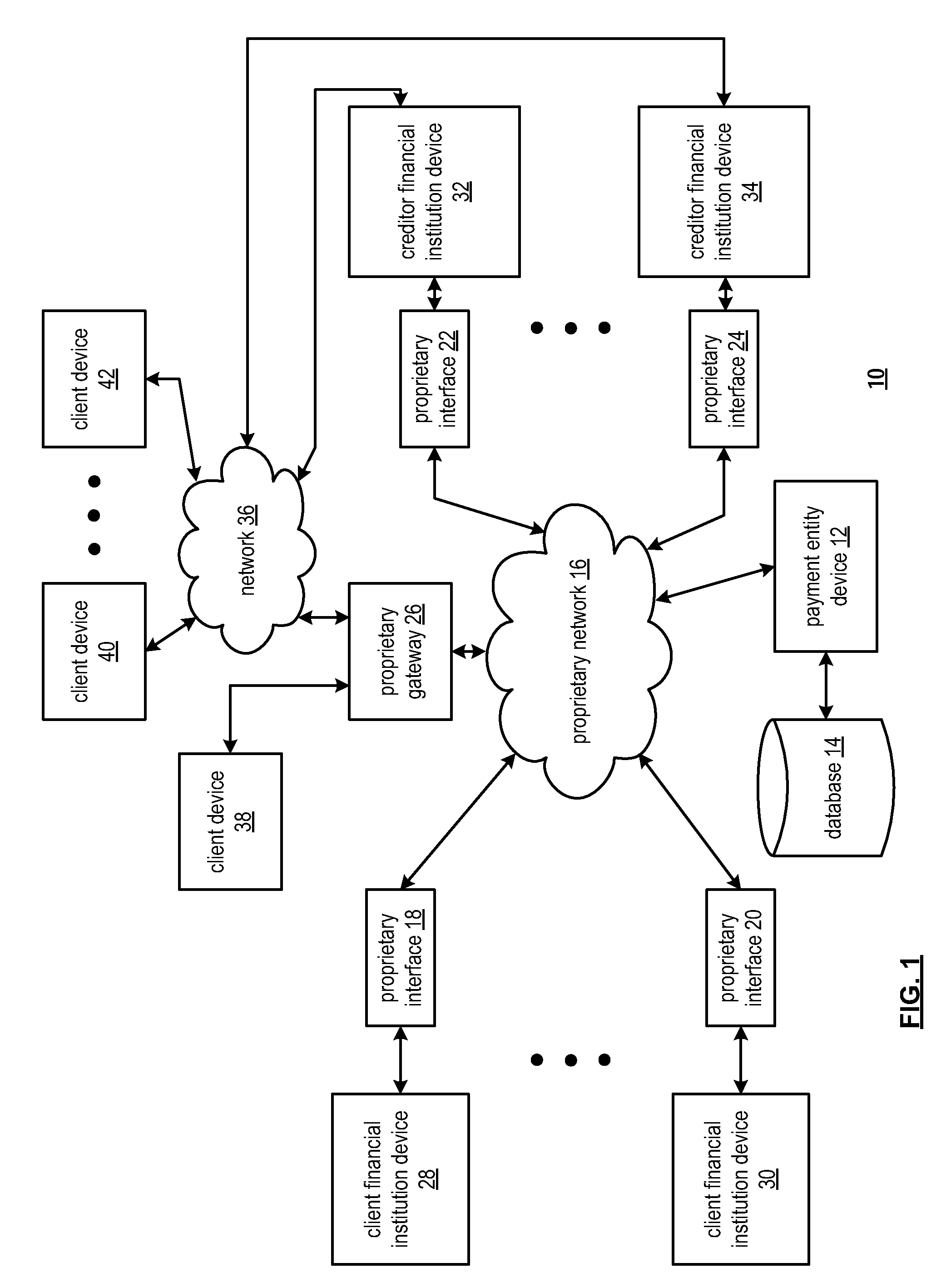

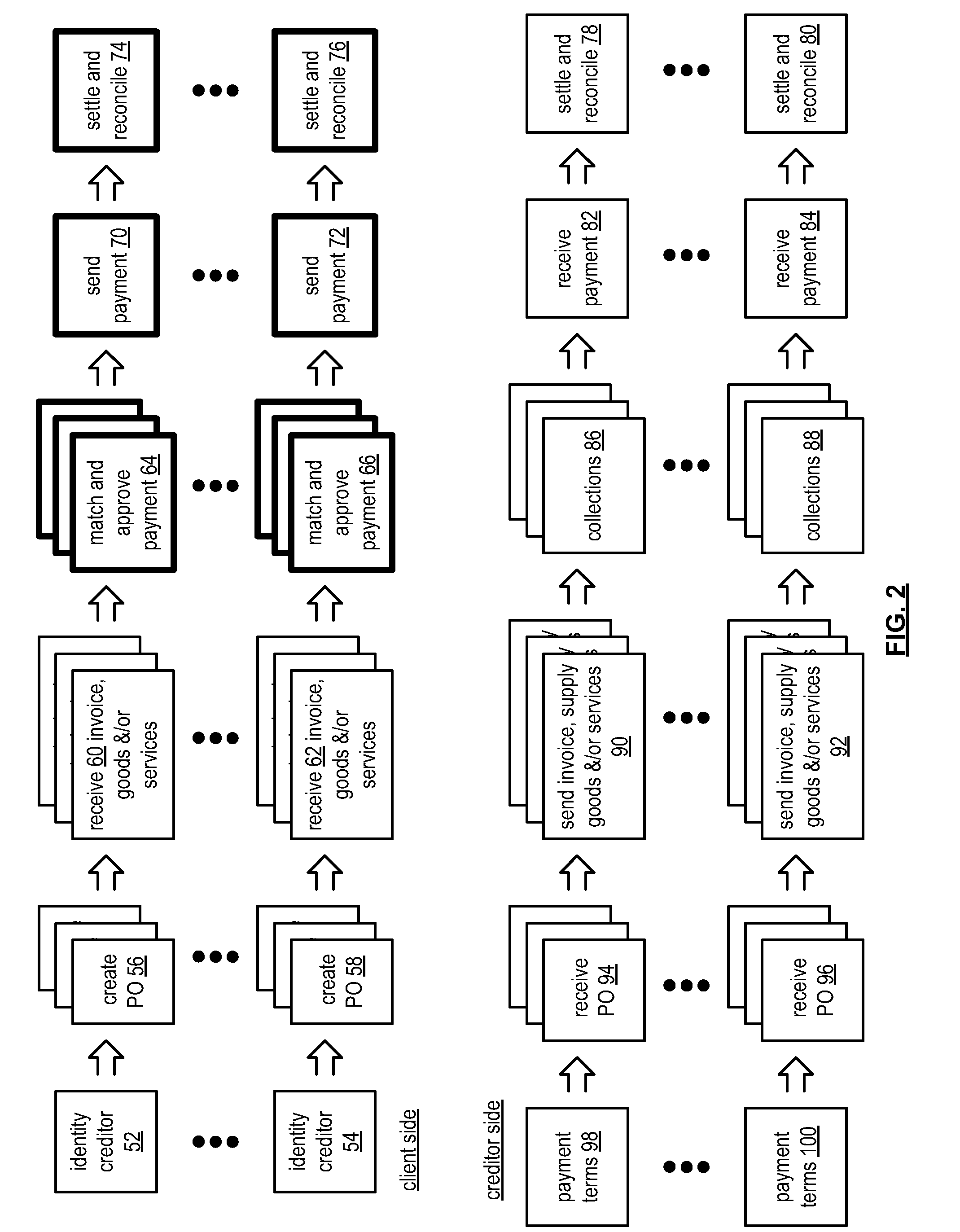

Payment entity device transaction processing using multiple payment methods

A method begins with a payment entity device receiving an accounts payable data file from a client entity processing module. The method continues with the payment entity device determining a method of payment for an account payable of the accounts payable data file in accordance with a payables profile. The method continues with the payment entity device initiating a first type of payment for the account payable when the method of payment is a first type; initiating a second type of payment for the account payable, when the method of payment is a second type, or initiating a third type of payment for the account payable when the method of payment is a third type.

Owner:VISA USA INC (US)

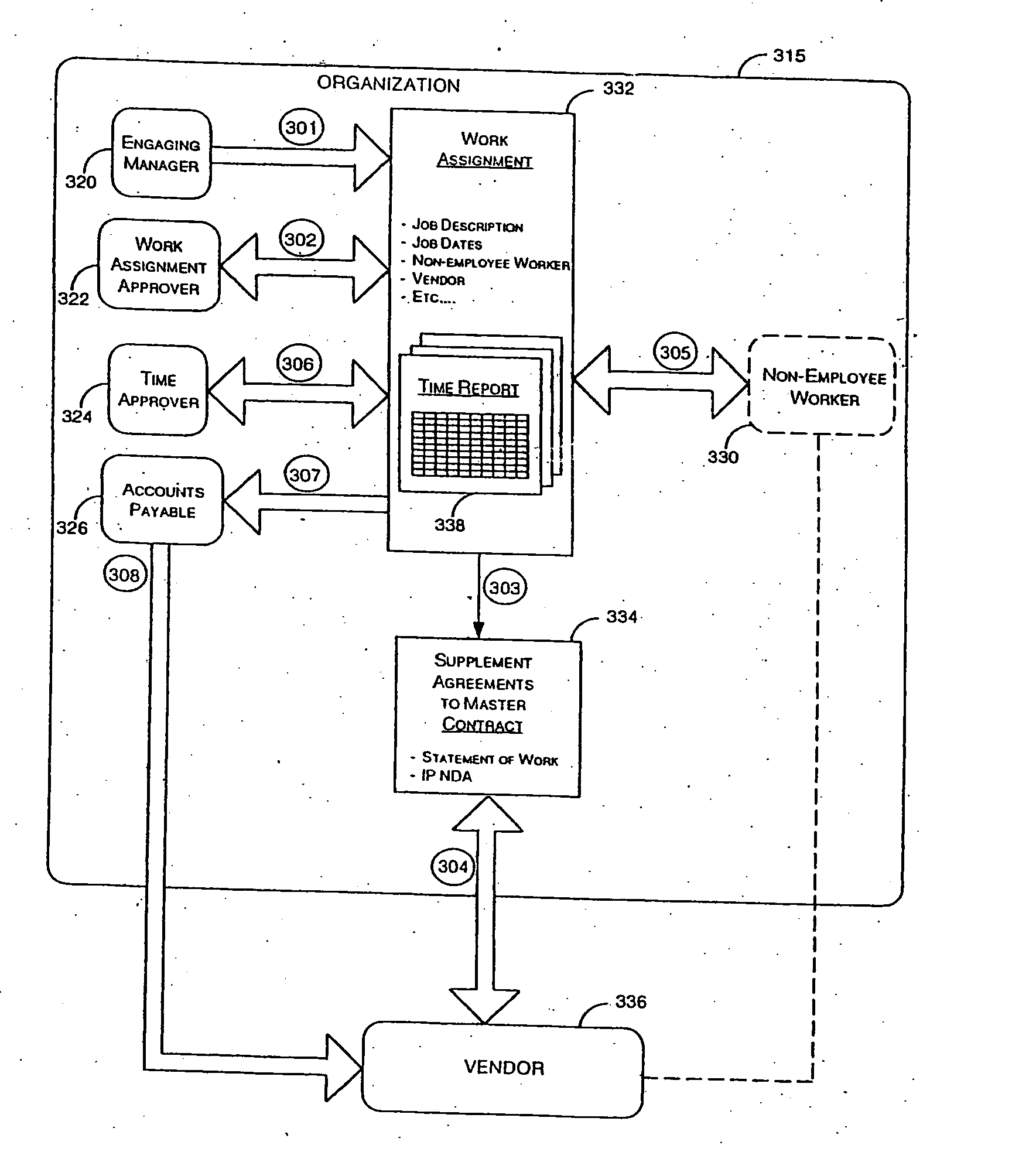

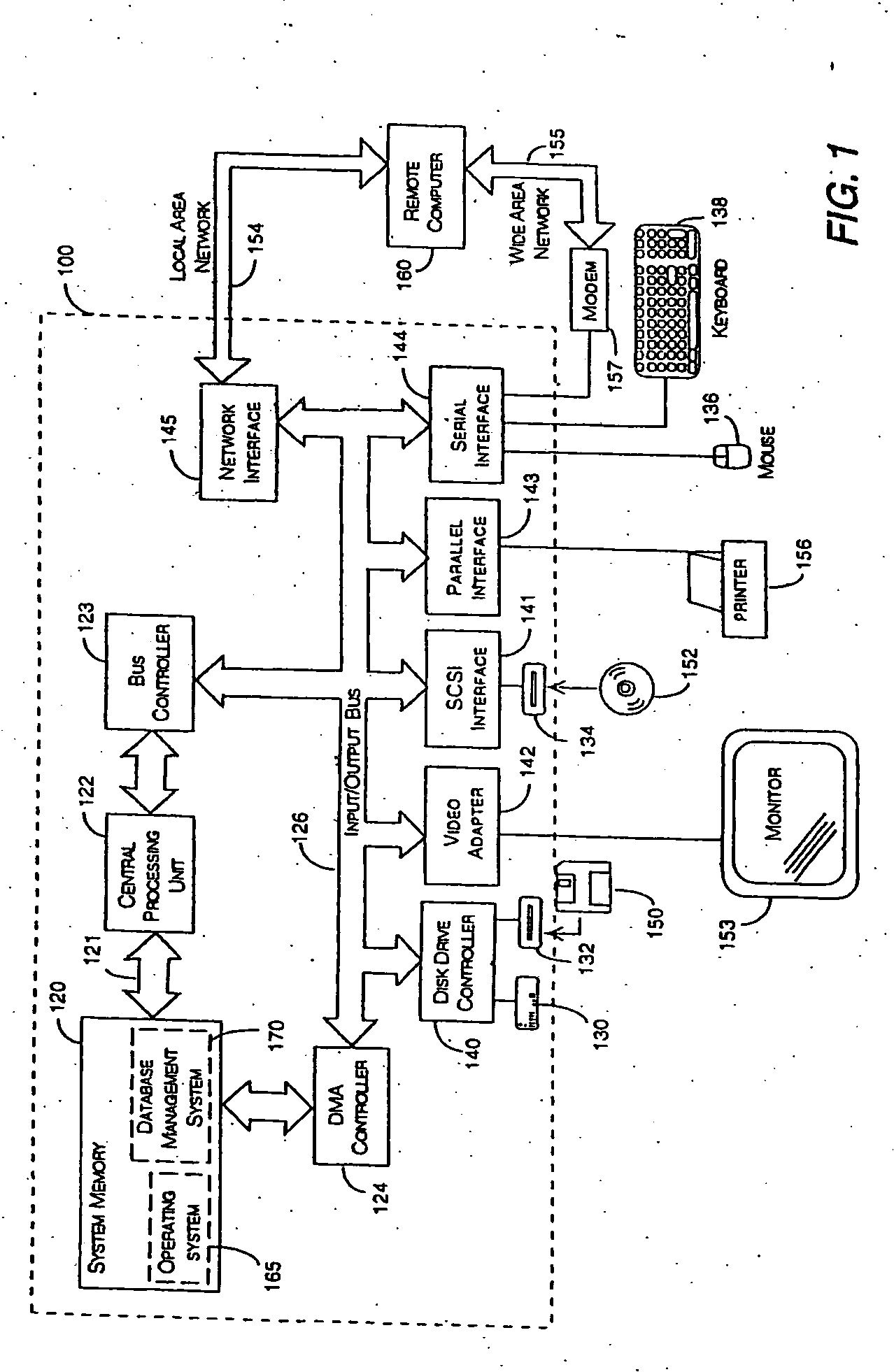

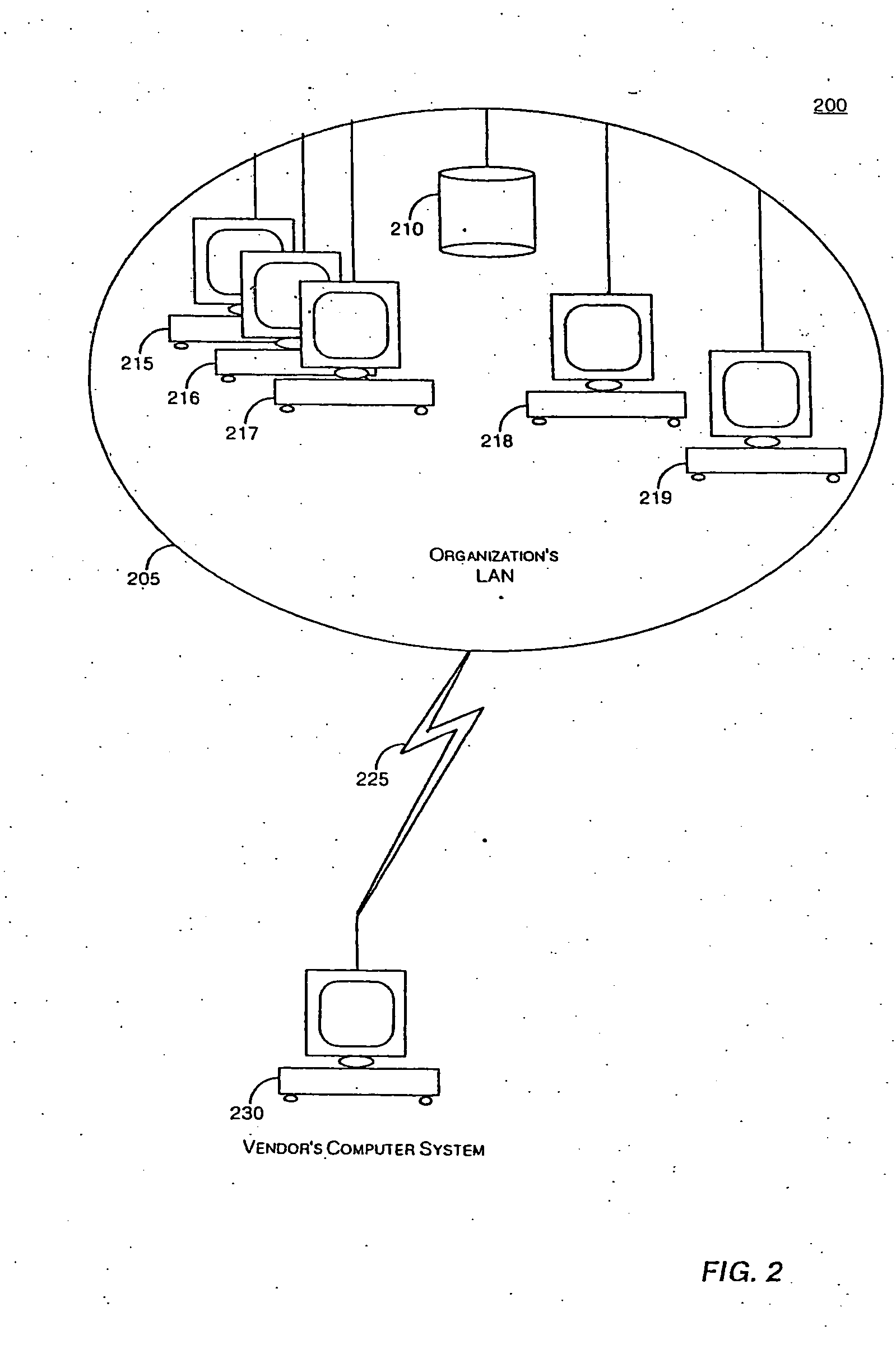

Engagement of non-employee workers

InactiveUS20050010467A1Multiple digital computer combinationsOffice automationJob descriptionWork task

Assisting an organization in managing the engagement of non-employee workers supplied by a vendor. The organization maintains a computer system that is linked to a vendor's computer system. Electronic communication allows for sharing of information between the organization's computer system and the vendor's computer system. A database management system is provided for accessing a database to create, modify, store and access non-employee worker profiles, requests for non-employee workers, work assignments, time reports, and possibly electronic versions of employment agreements. Electronic settlement means may transfer payments to the vendor in exchange for services rendered by the non-employee worker. An engaging manager may send an e-mail request to the vendor for a non-employee worker. The vendor may provide the engaging manager with an e-mail response listing all eligible non-employees workers. The engaging manager may then request a non-employee worker from the list and, via e-mail, seek approval from a supervisor for engaging the non-employee worker. An engaging manager may also search the non-employee worker profiles in the database in order to find a non-employee worker without sending an e-mail request to the vendor. Work assignments for non-employee workers are entered into the database. Work assignments may include a job description, an hourly billing rate, and identification information. A non-employee worker stores in the database a time report recording time worked against the work assignment. Time reports may be accessed by a time approver. Approved time is submitted to an accounts payable department, which handles payment of the vendor.

Owner:DIETZ JANICE GOLD +2

Loyalty Rewards Optimization Bill Payables and Receivables Service

For several accounts receivable, a reward account is determined as the account that receives the largest deposit to the loyalty reward balance thereof by a payment of the account receivable. For each reward account, a deficient reward account is found if the currency balance for the reward account is not sufficient for the payment of the account payable. For each deficiency reward account, if identified accounts receivables can be deposited such that the currency balance thereof will be sufficient to pay the account payable, then payments are made of: (i) the identified accounts receivables as corresponding deposits to the currency balance of the deficiency reward account such that the currency balance thereof is sufficient for the payment of the account payable; and (ii) the account payable by a withdrawal from the currency balance of the deficiency reward account.

Owner:VISA USA INC (US)

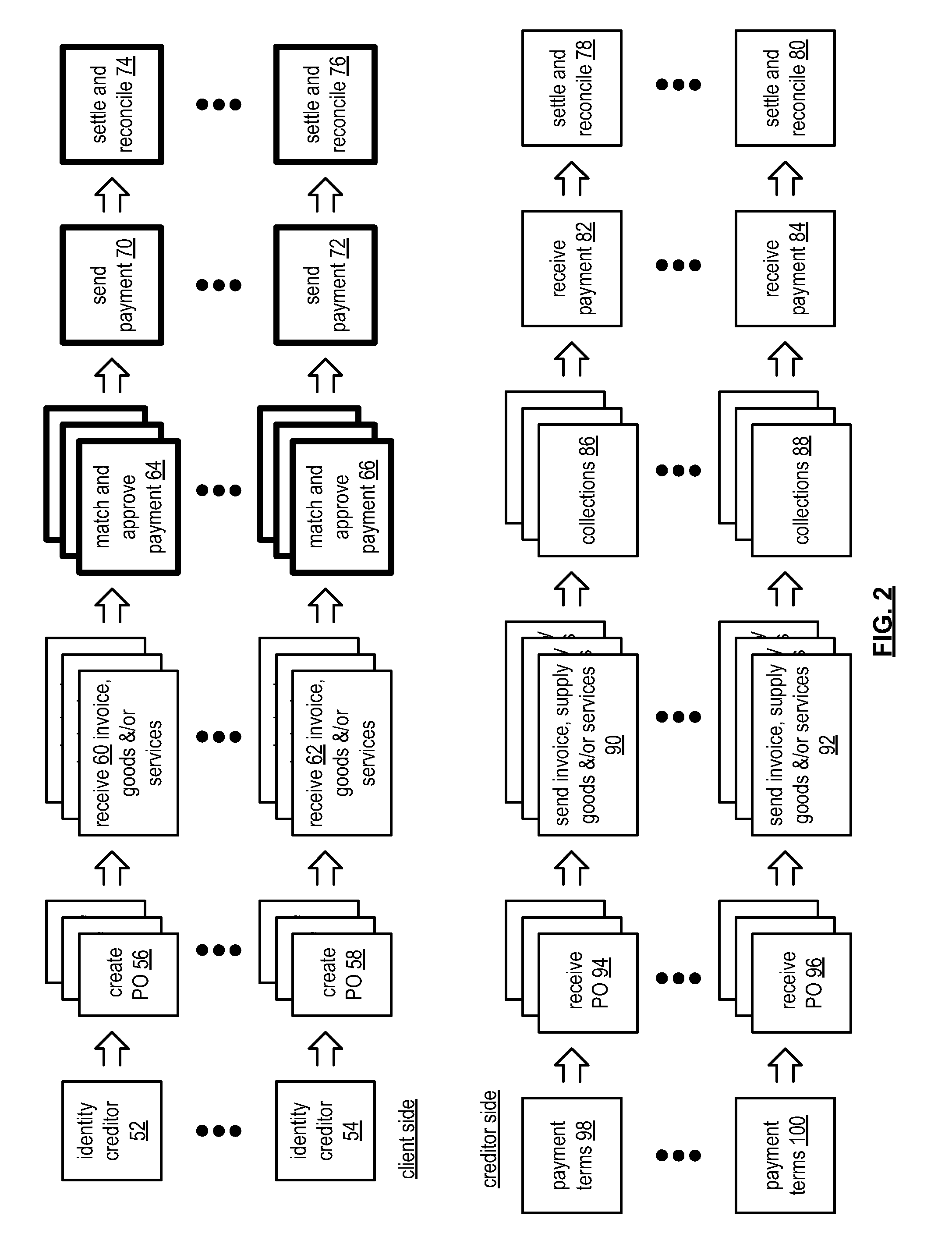

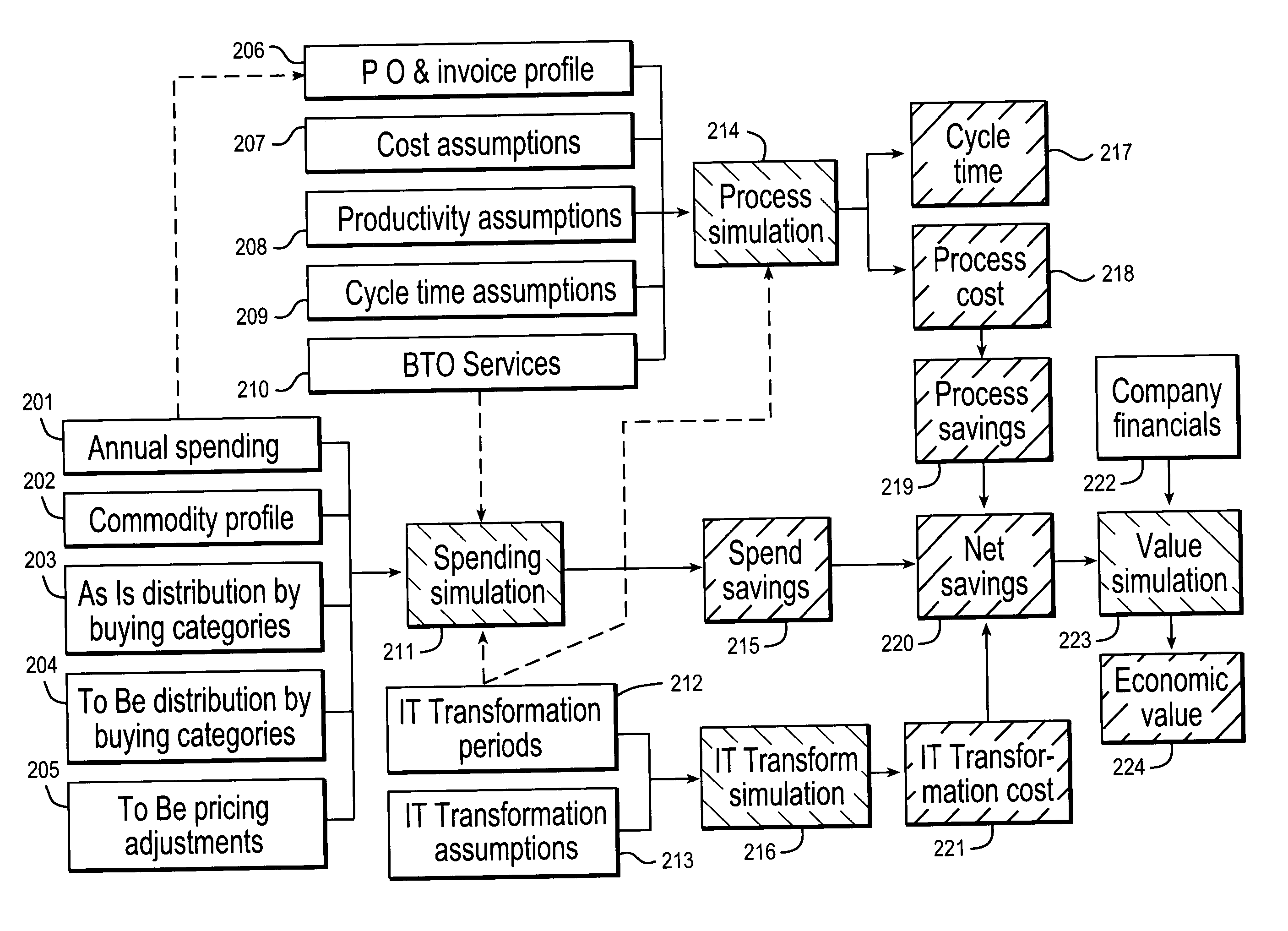

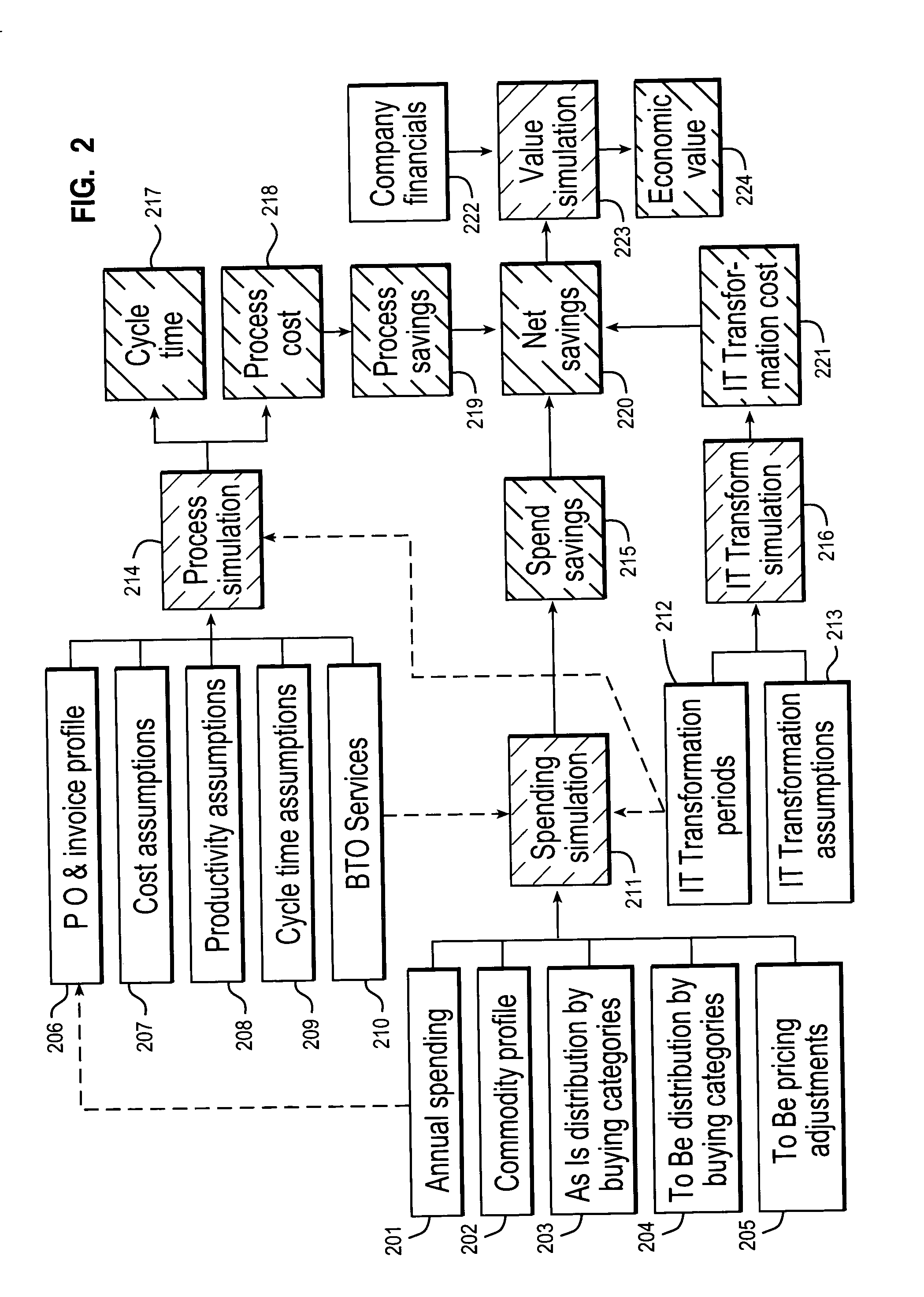

Simulation of business transformation outsourcing of sourcing, procurement and payables

InactiveUS20050065831A1Data processing applicationsSpecial data processing applicationsAccounts payableClient organization

An example of a solution provided here comprises: performing a spending simulation, process simulation, information technology simulation, and value simulation, providing interactions among the simulations, and representing with the simulations the use by a client organization of one or more business transformation outsourcing services, such as sourcing, procurement, and payables.

Owner:IBM CORP

Payment entity for account payables processing using multiple payment methods

A method begins by receiving an accounts payable data file from a client device. The method continues by determining whether a payables profile of a client associated with the client device is to be modified based on the accounts payable data file. The method continues by determining a level of service of the client when the payables profile is not to be modified. The method continues processing payment transactions for accounts payable contained in the accounts payable data file on behalf of the client in accordance with the payables profile via a wide area network when the level of service is a first level of service.

Owner:VISA USA INC (US)

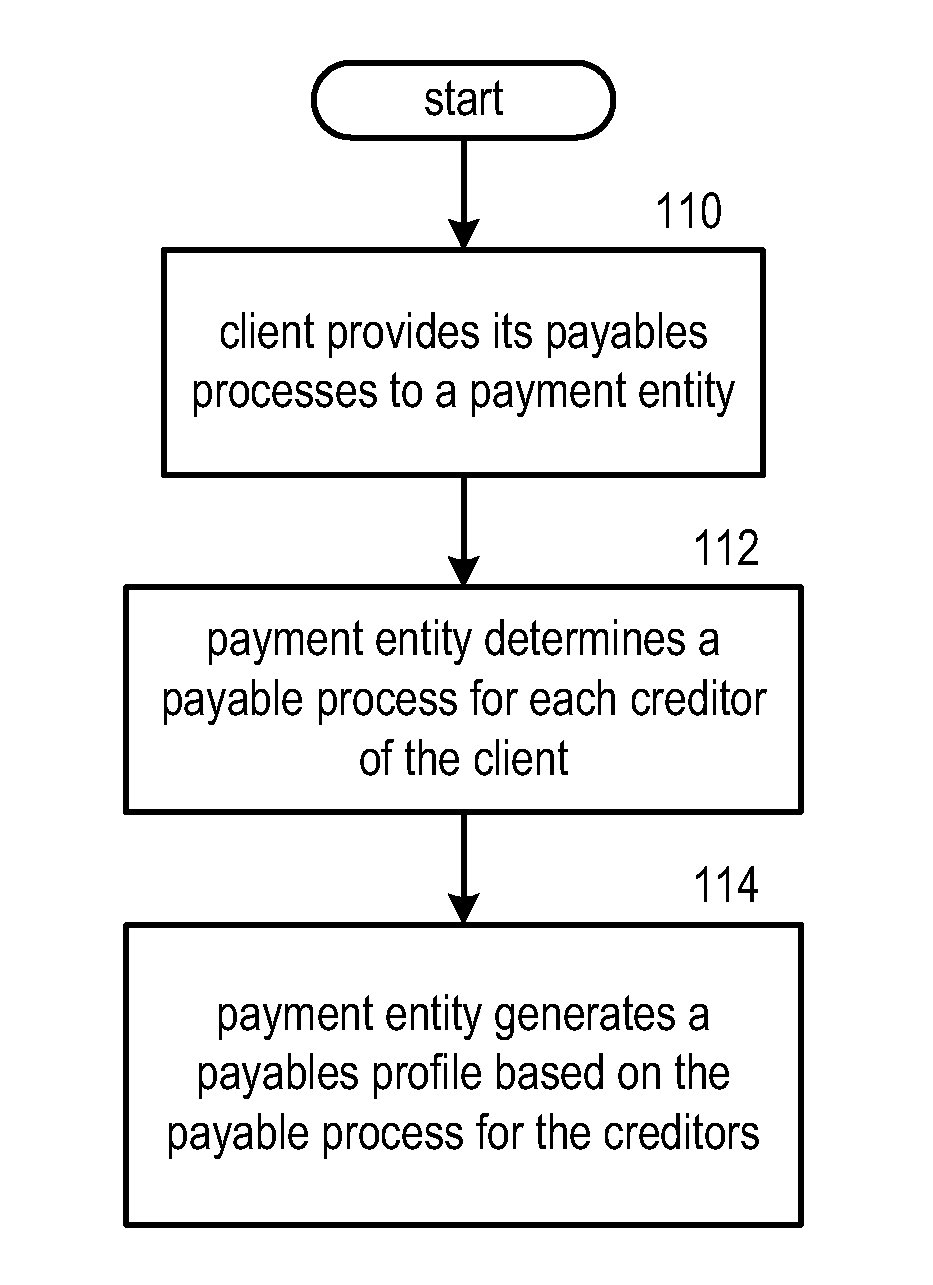

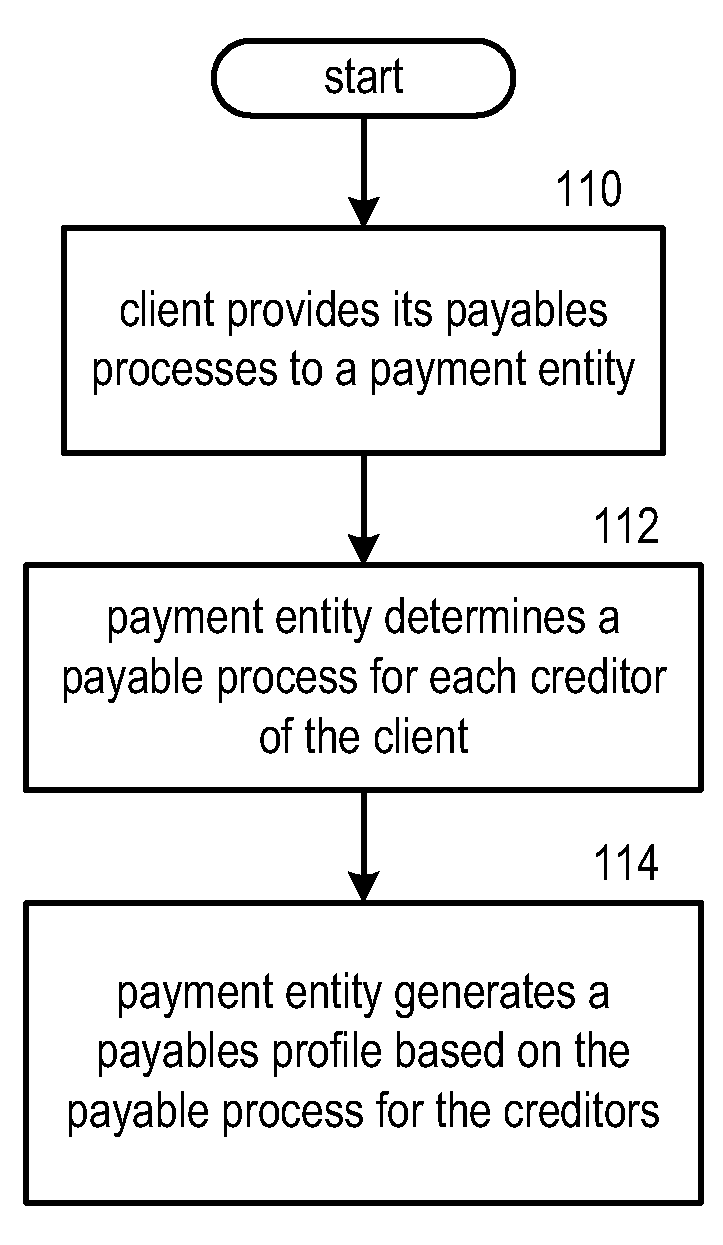

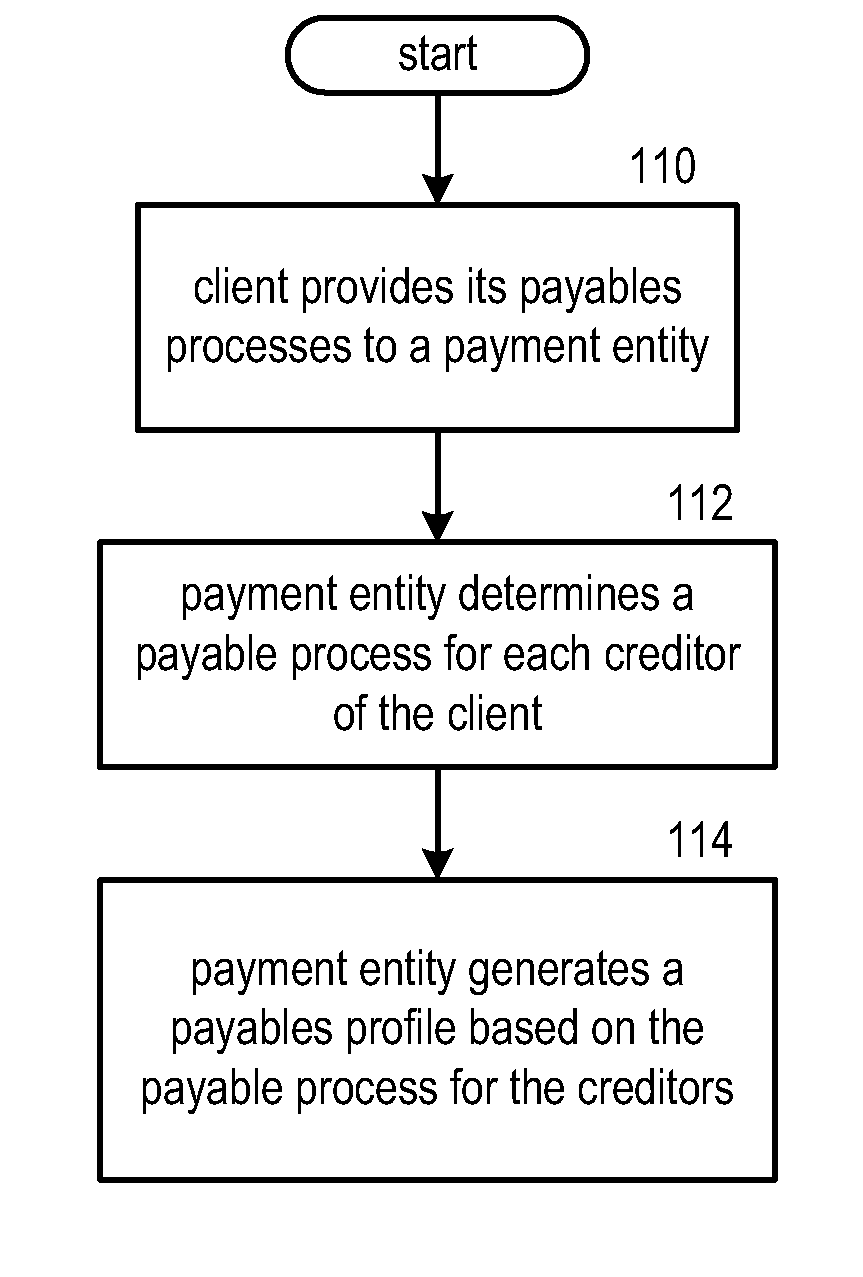

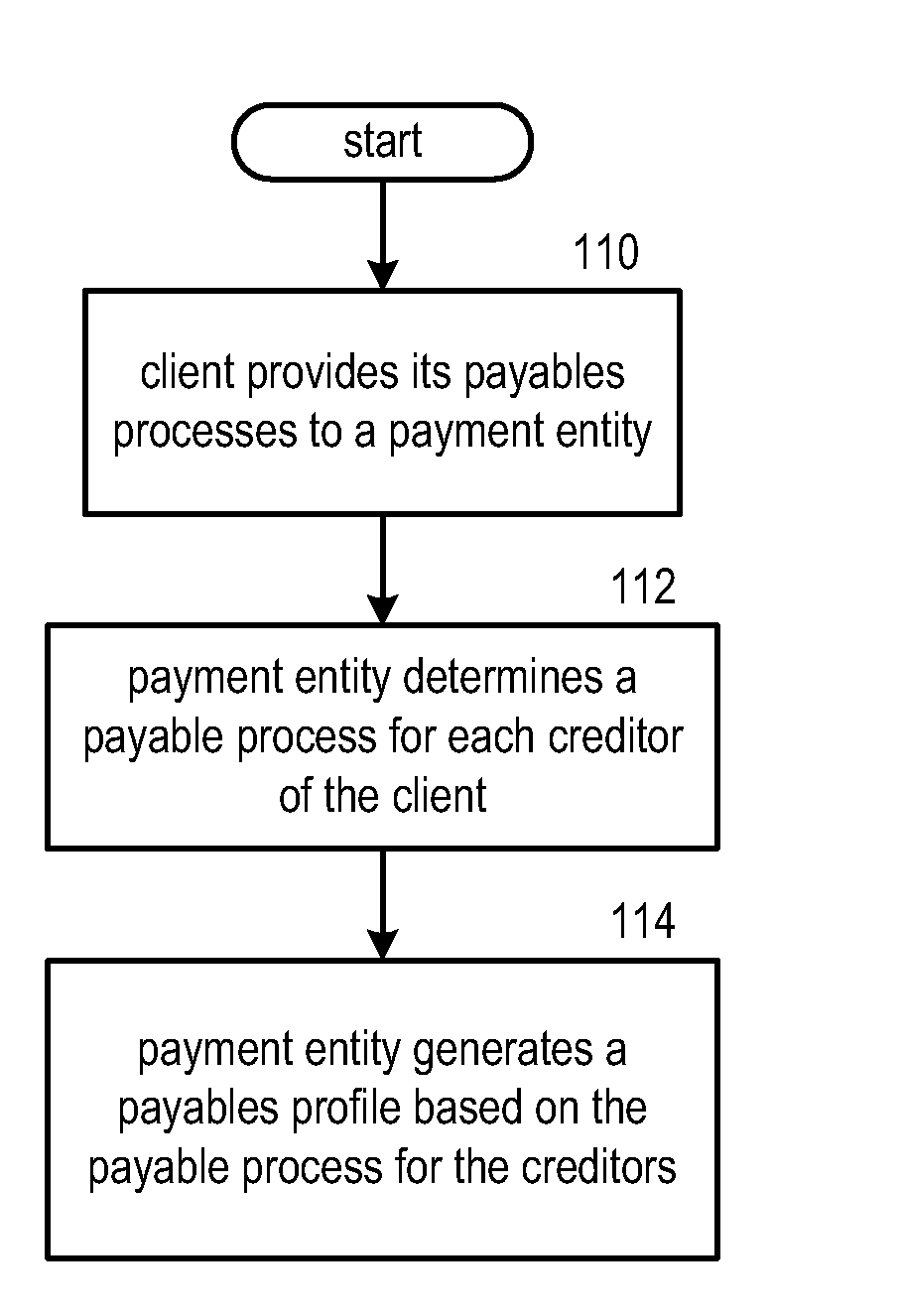

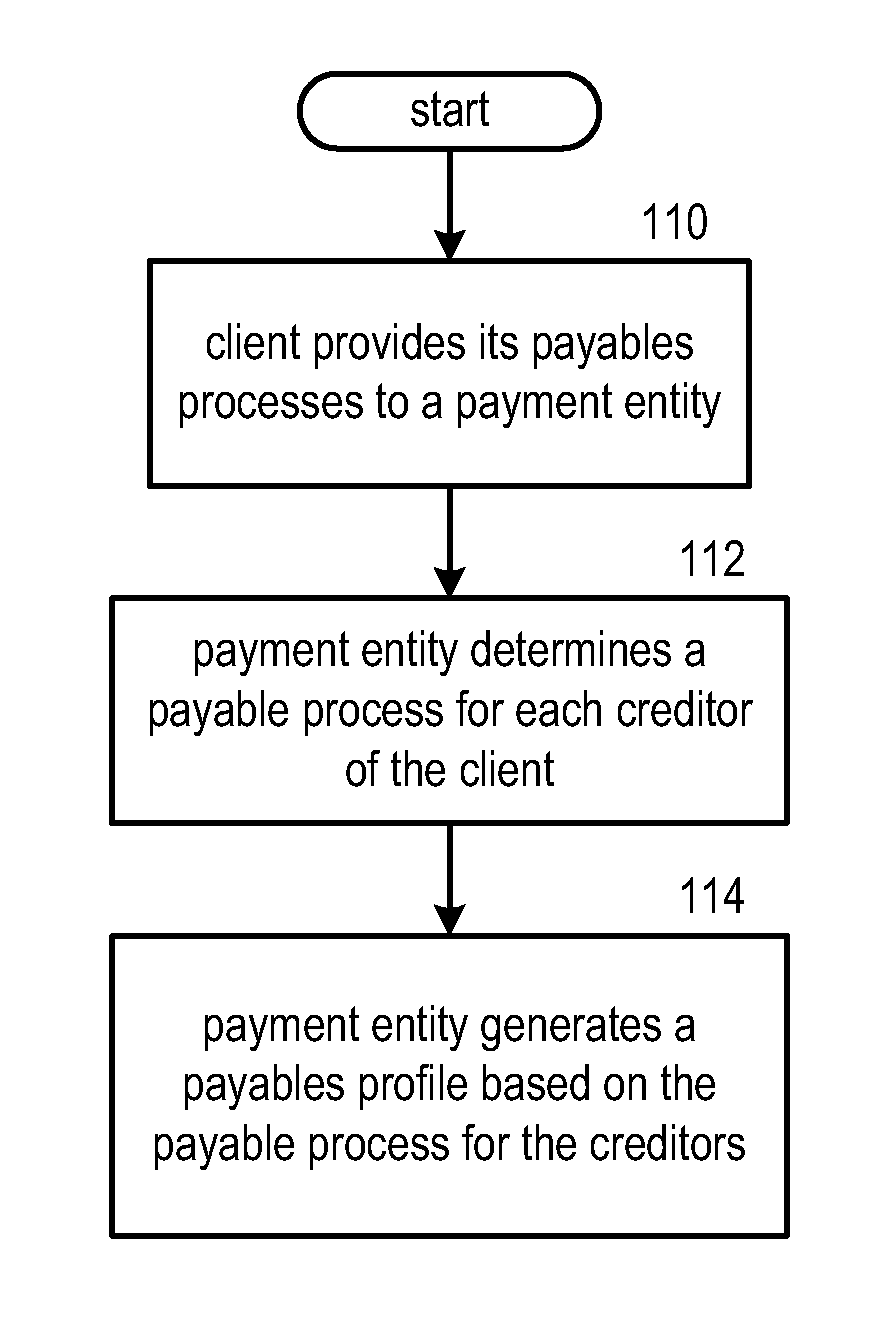

Payment entity account set up for multiple payment methods

A method begins with a payment entity device receiving payables process data from a client device. The payables process data includes a list of a plurality of creditors and associated payment data, wherein, for a creditor of the plurality of creditors, the associated payment data includes at least one payment scheme for paying at least a portion of debt owed to the creditor via at least one of: a client credit card, a funds transfer, commercial paper, tangible consideration, and a debit account. The method continues with the payment entity device determining level of service for a client associated with the client device. The method continues with the payment entity device generating a payables profile for the client based on the payables process data in accordance with the level of service.

Owner:VISA USA INC (US)

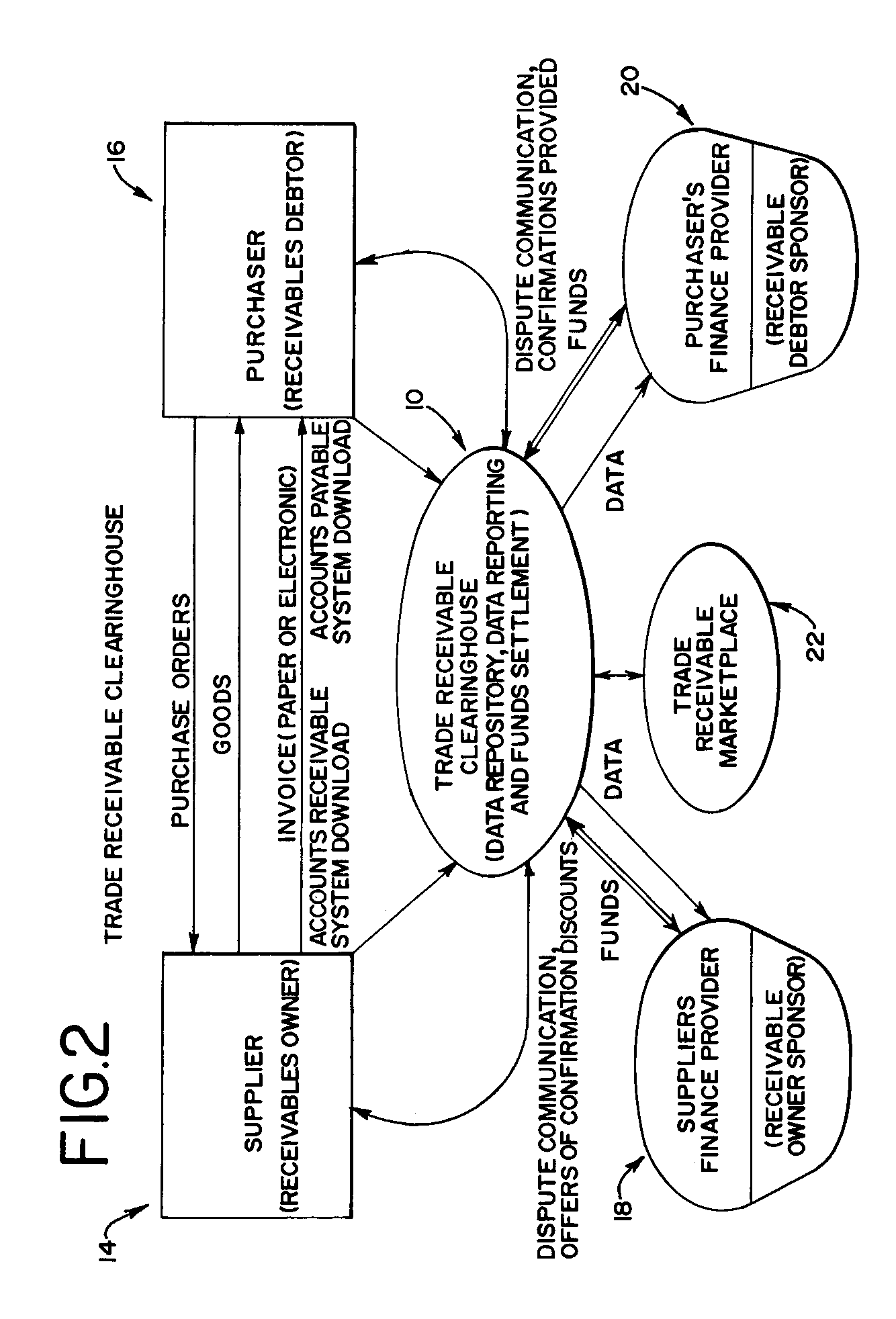

Trade receivable processing method and apparatus

A processing method and apparatus is provided, such as a clearinghouse, for tracking receivable and payable information, matching, negotiating, trading, providing working capital financing, and settling payments for accounts payable and accounts receivable between trading partners and finance providers.

Owner:JPMORGAN CHASE BANK NA +1

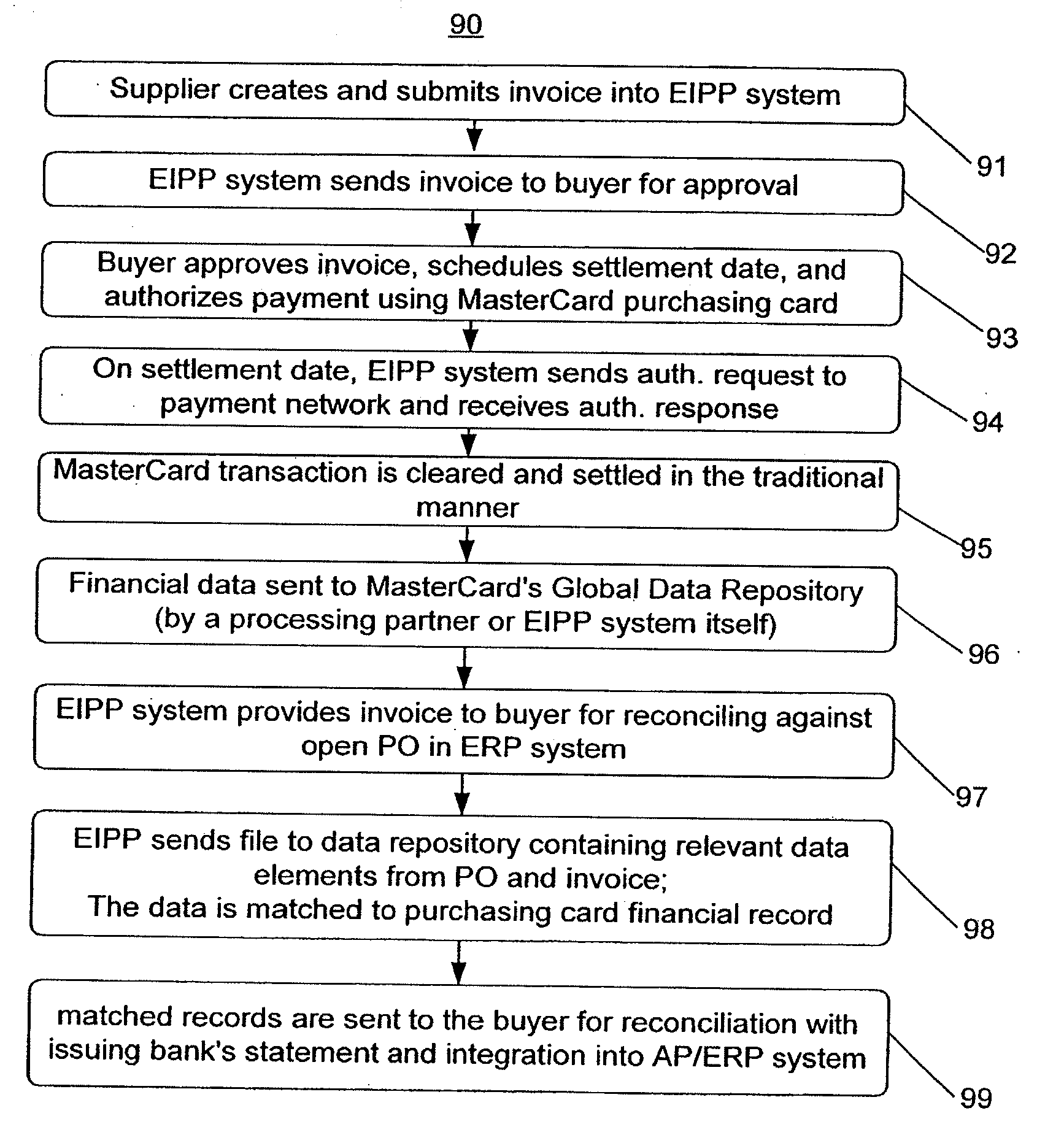

System And Method For Integrated Electronic Invoice Presentment And Payment

InactiveUS20090132414A1Facilitate an electronic payment of the electronic invoiceFinanceCredit schemesAccounts payableInvoice

A system and method is provided for an electronic invoice presentment and payment management service. The system and method automatically link electronic purchase orders, invoices, receipt-of-goods documents, and other transaction-related information to a payment card transaction, such as a purchasing card transaction. The system may be used in conjunction with existing infrastructure and the systems currently employed by a buyer organization and a supplier organization. The system provides for the delivery of Level III data (invoice detail) with every payment card transaction and automatically inputs this Level III detailed transaction data into the buyer's accounts payable system and enterprise resource planning system.

Owner:MASTERCARD INT INC

Payment entity account set up for multiple payment methods

A method begins with a payment entity device receiving payables process data from a client device. The payables process data includes a list of a plurality of creditors and associated payment data, wherein, for a creditor of the plurality of creditors, the associated payment data includes at least one payment scheme for paying at least a portion of debt owed to the creditor via at least one of: a client credit card, a funds transfer, commercial paper, tangible consideration, and a debit account. The method continues with the payment entity device determining level of service for a client associated with the client device. The method continues with the payment entity device generating a payables profile for the client based on the payables process data in accordance with the level of service.

Owner:VISA USA INC (US)

Payment entity device transaction processing using multiple payment methods

A method begins with a payment entity device receiving an accounts payable data file from a client entity processing module. The method continues with the payment entity device determining a method of payment for an account payable of the accounts payable data file in accordance with a payables profile. The method continues with the payment entity device initiating a first type of payment for the account payable when the method of payment is a first type; initiating a second type of payment for the account payable, when the method of payment is a second type, or initiating a third type of payment for the account payable when the method of payment is a third type.

Owner:VISA USA INC (US)

Payment entity for account payables processing using multiple payment methods

A method begins by receiving an accounts payable data file from a client device. The method continues by determining whether a payables profile of a client associated with the client device is to be modified based on the accounts payable data file. The method continues by determining a level of service of the client when the payables profile is not to be modified. The method continues processing payment transactions for accounts payable contained in the accounts payable data file on behalf of the client in accordance with the payables profile via a wide area network when the level of service is a first level of service.

Owner:VISA USA INC (US)

Payment entity device reconciliation for multiple payment methods

A method begins by storing payment request data, which, for a client, includes a payables profile and an accounts payable data file. The method continues by receiving payment remittance information subsequent to initiation of a payment in accordance with the payment request data. The method continues by storing the payment remittance information. The method continues by consolidating the payment remittance information and the payment request data to produce consolidated payment data. The method continues by generating at least one report based on the consolidated payment data.

Owner:VISA USA INC (US)

Payment entity for account payables processing using multiple payment methods

A method begins by receiving an accounts payable data file from a client device. The method continues by determining whether a payables profile of a client associated with the client device is to be modified based on the accounts payable data file. The method continues by determining a level of service of the client when the payables profile is not to be modified. The method continues processing payment transactions for accounts payable contained in the accounts payable data file on behalf of the client in accordance with the payables profile via a wide area network when the level of service is a first level of service.

Owner:VISA USA INC (US)

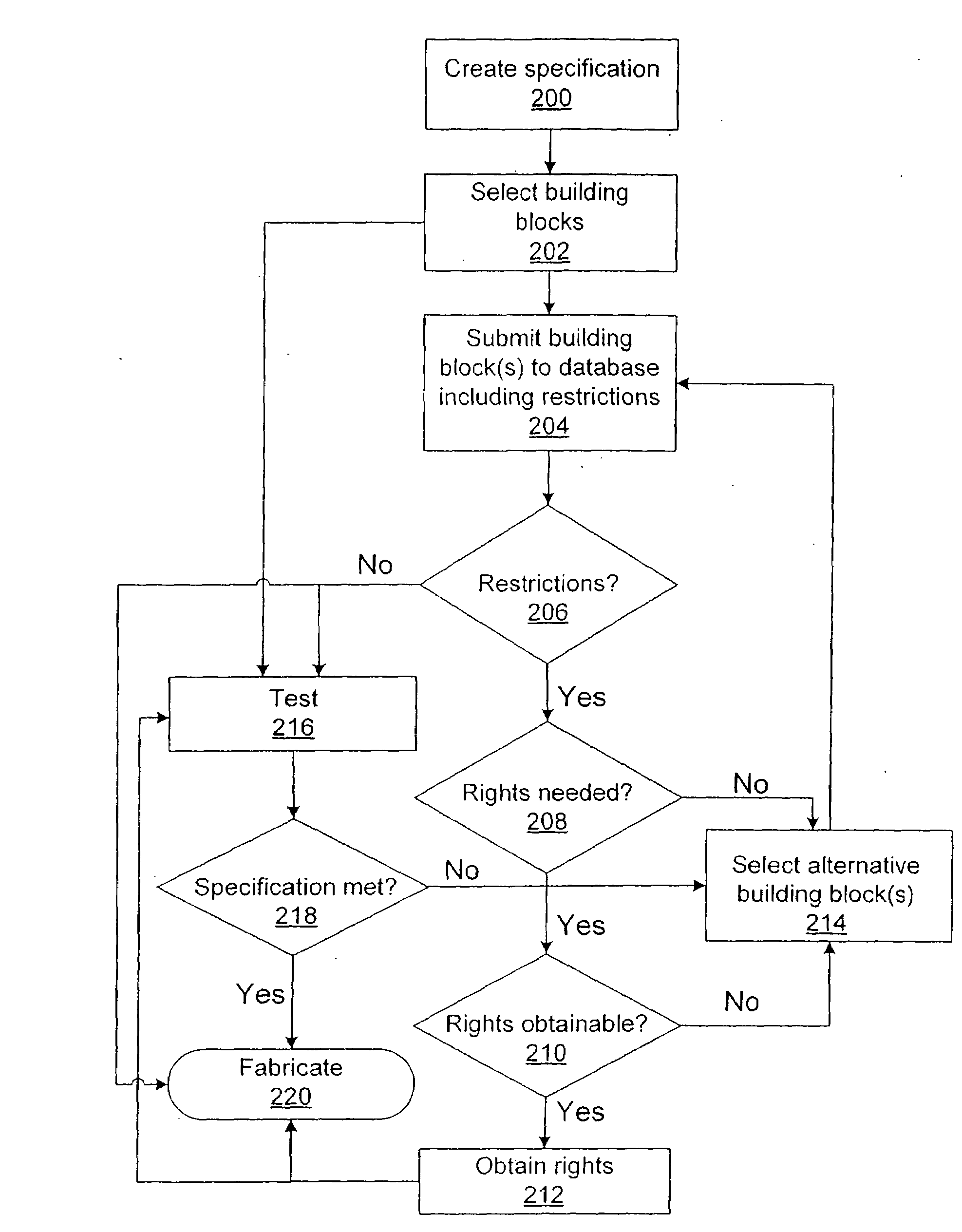

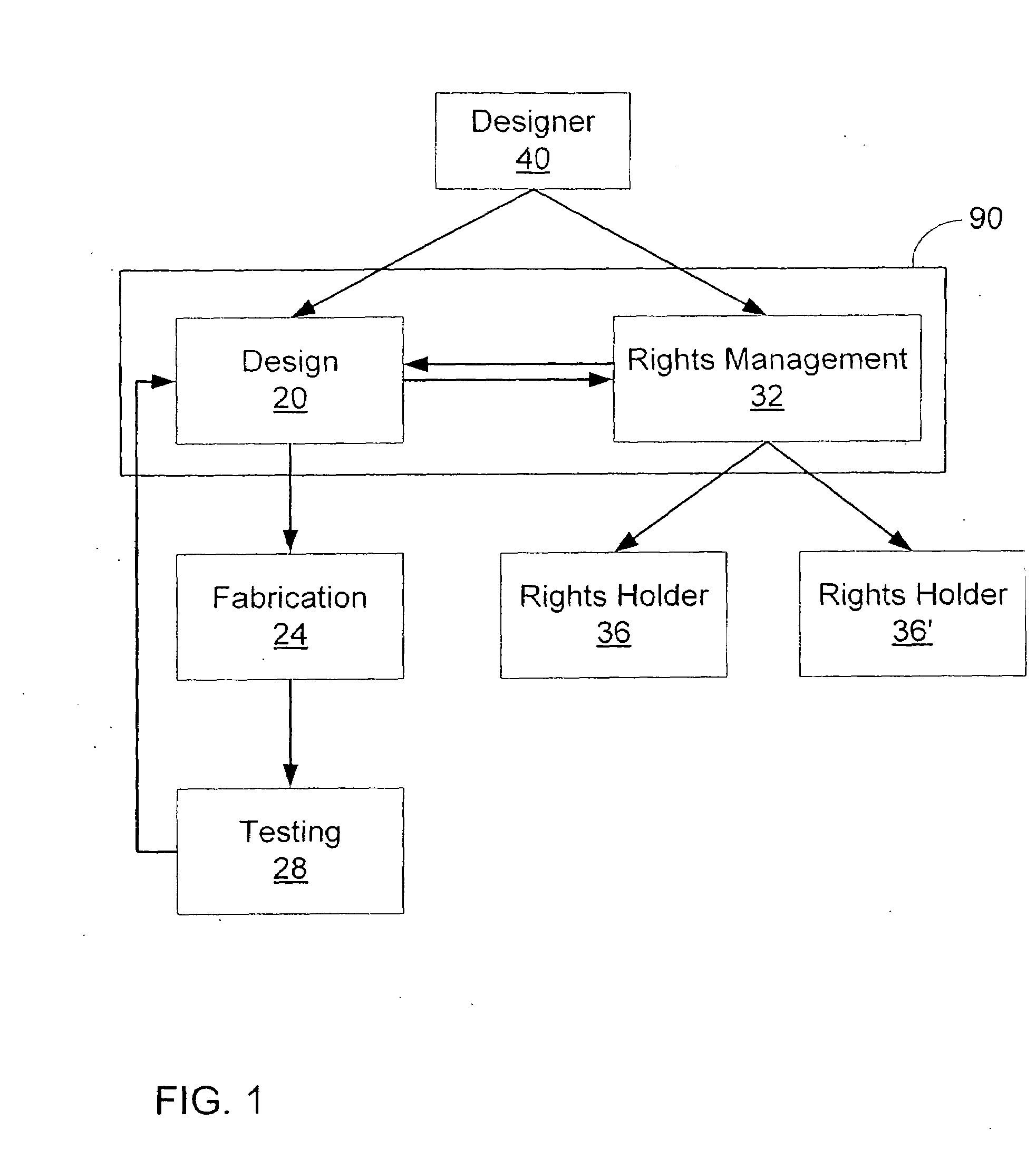

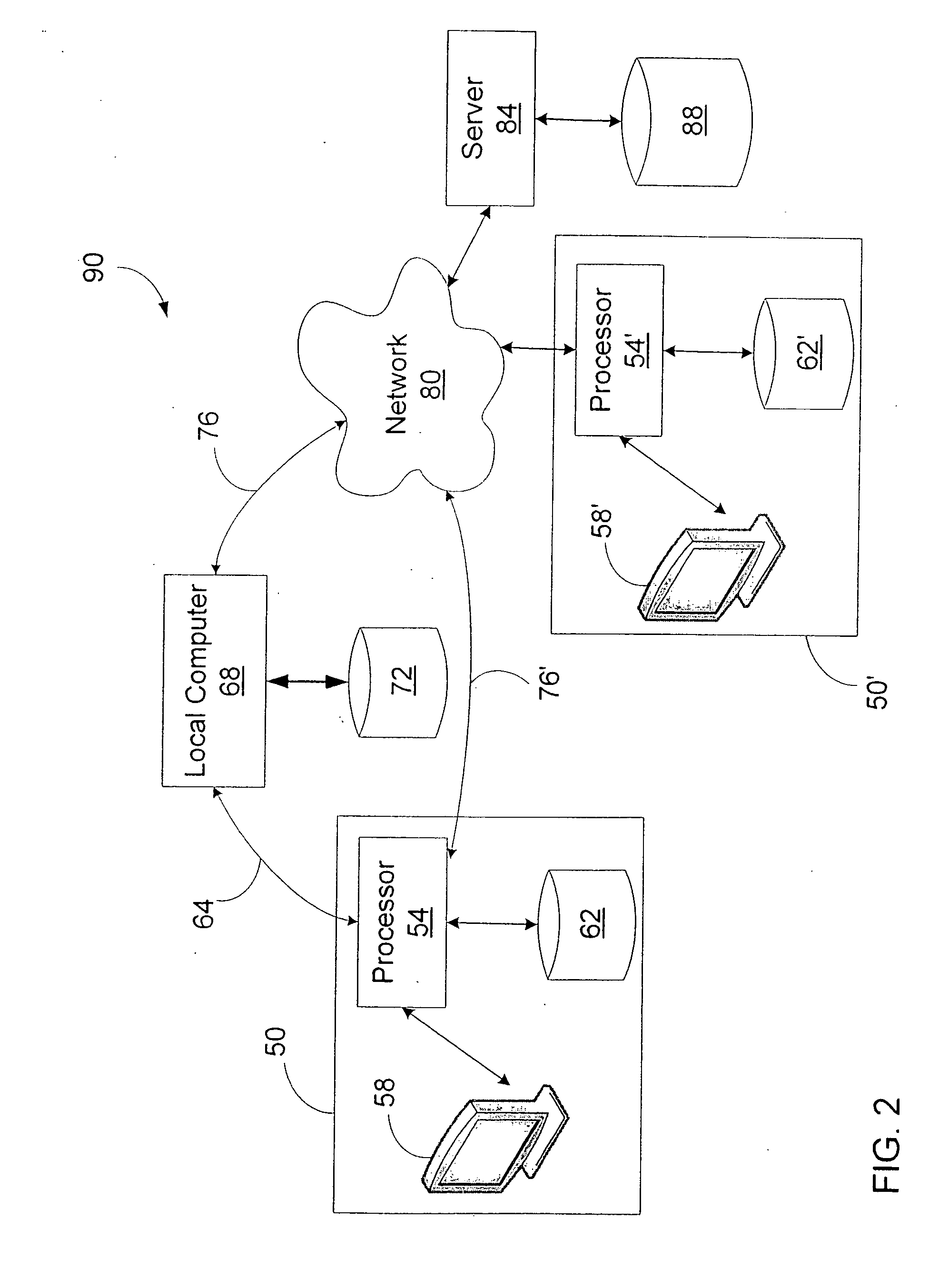

Methods, systems, and apparatus for facilitating the design of molecular constructs

InactiveUS20090137408A1Increase contentData augmentationData processing applicationsLibrary screeningThird partyFeature set

A system and method for aiding in the design of molecular constructs is provided. A feature set associated with a molecular building block in a construct may be determined, wherein the feature set may comprise data indicative of third party rights that restrict use of the molecular segment or the lack of such rights. The method may include steps of defining a molecular structure for use in the construct; searching a database including a plurality of molecular structures and a plurality of rights, each right of the plurality of rights associated with each of the plurality of molecular structures; and displaying rights associated with the defined molecular structures in response to the search of said database. The system may include a library aggregating a plurality of intellectual property rights relating to fabricating biological constructs; a licensing module licensing the intellectual property rights required to make the specific construct for a fee; an accounts receivable module receiving the fee from a potential maker of the specific construct; and an accounts payable module distributing remuneration to the holders of the intellectual property rights required to make the specific construct.

Owner:CODON DEVICES

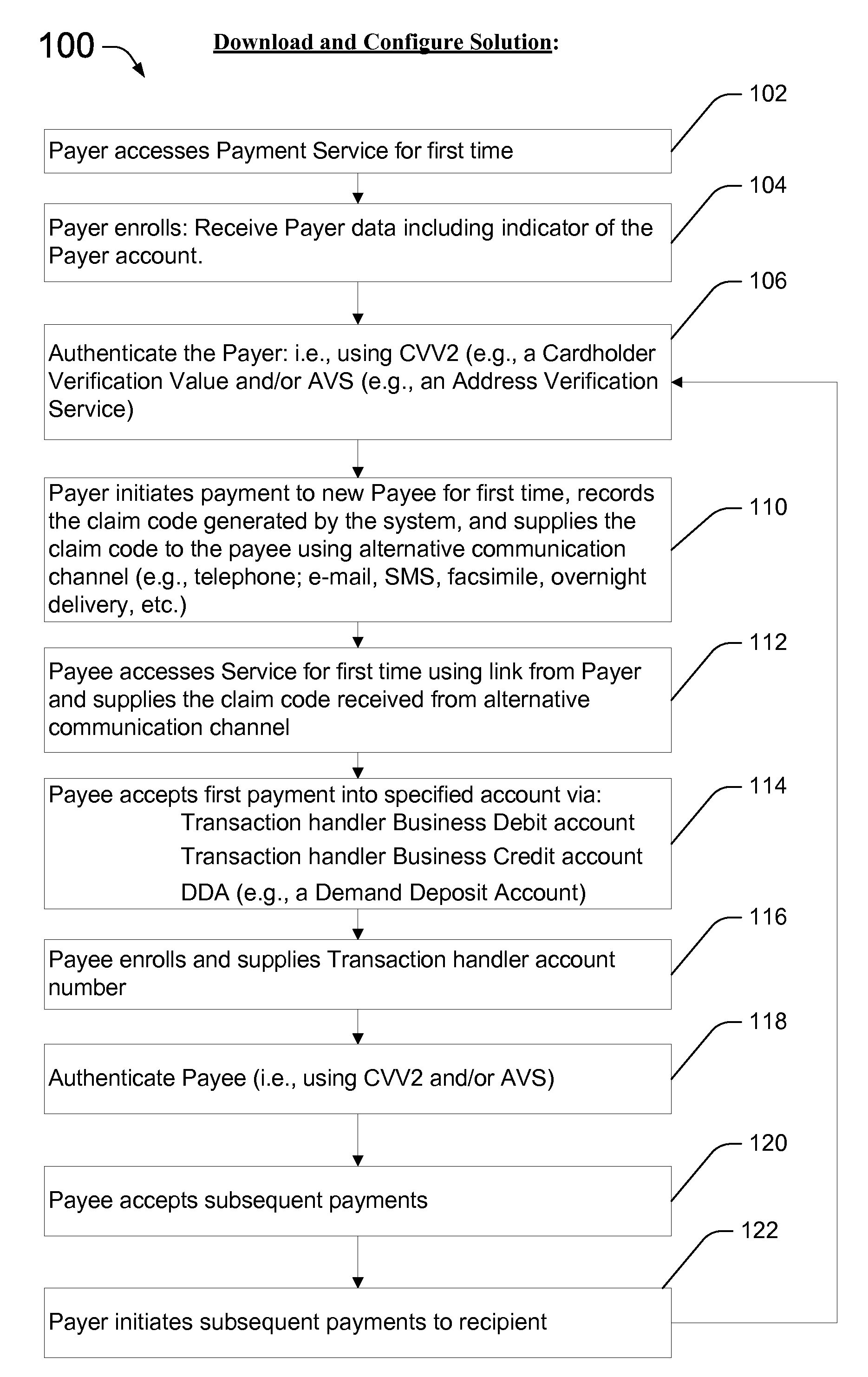

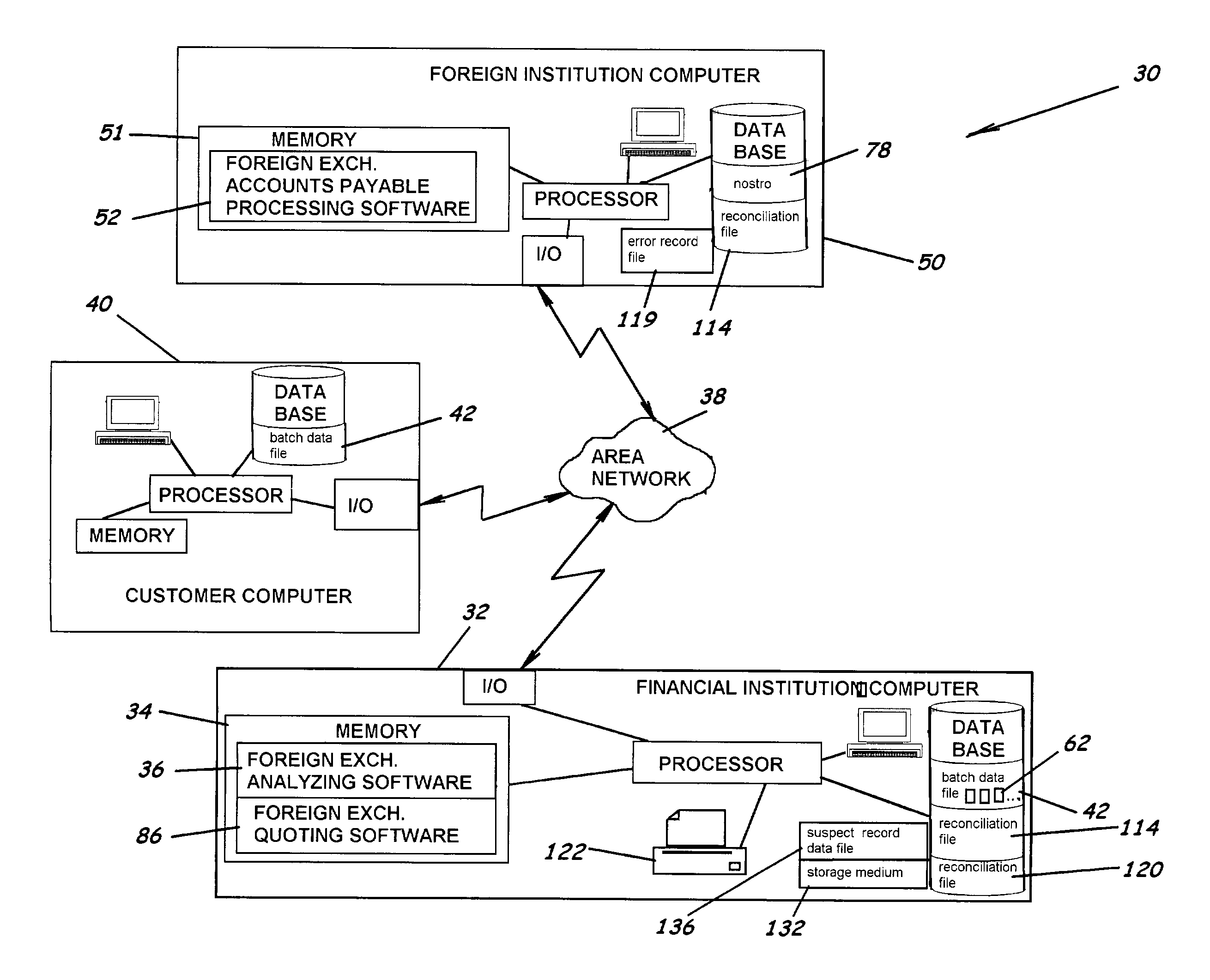

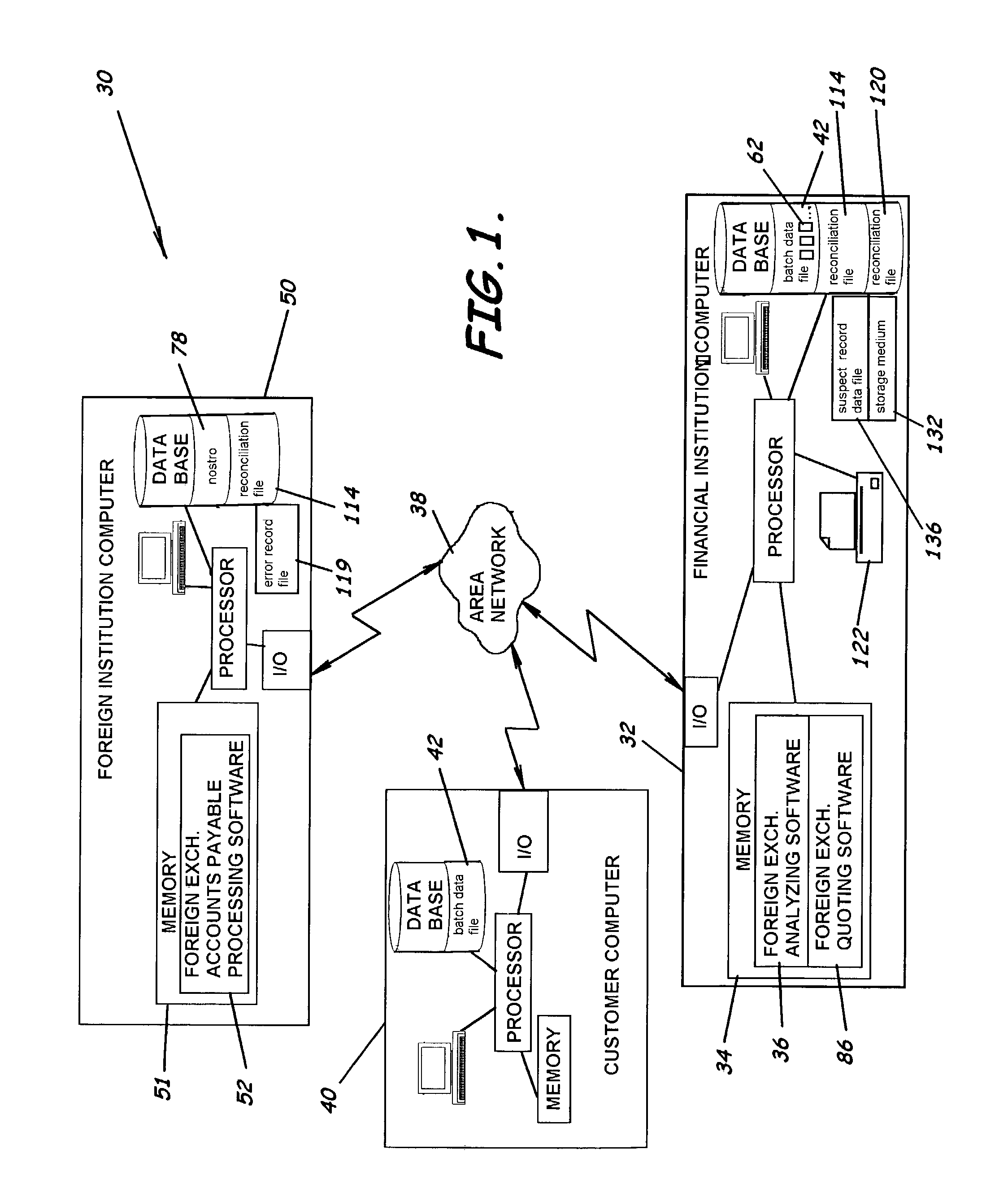

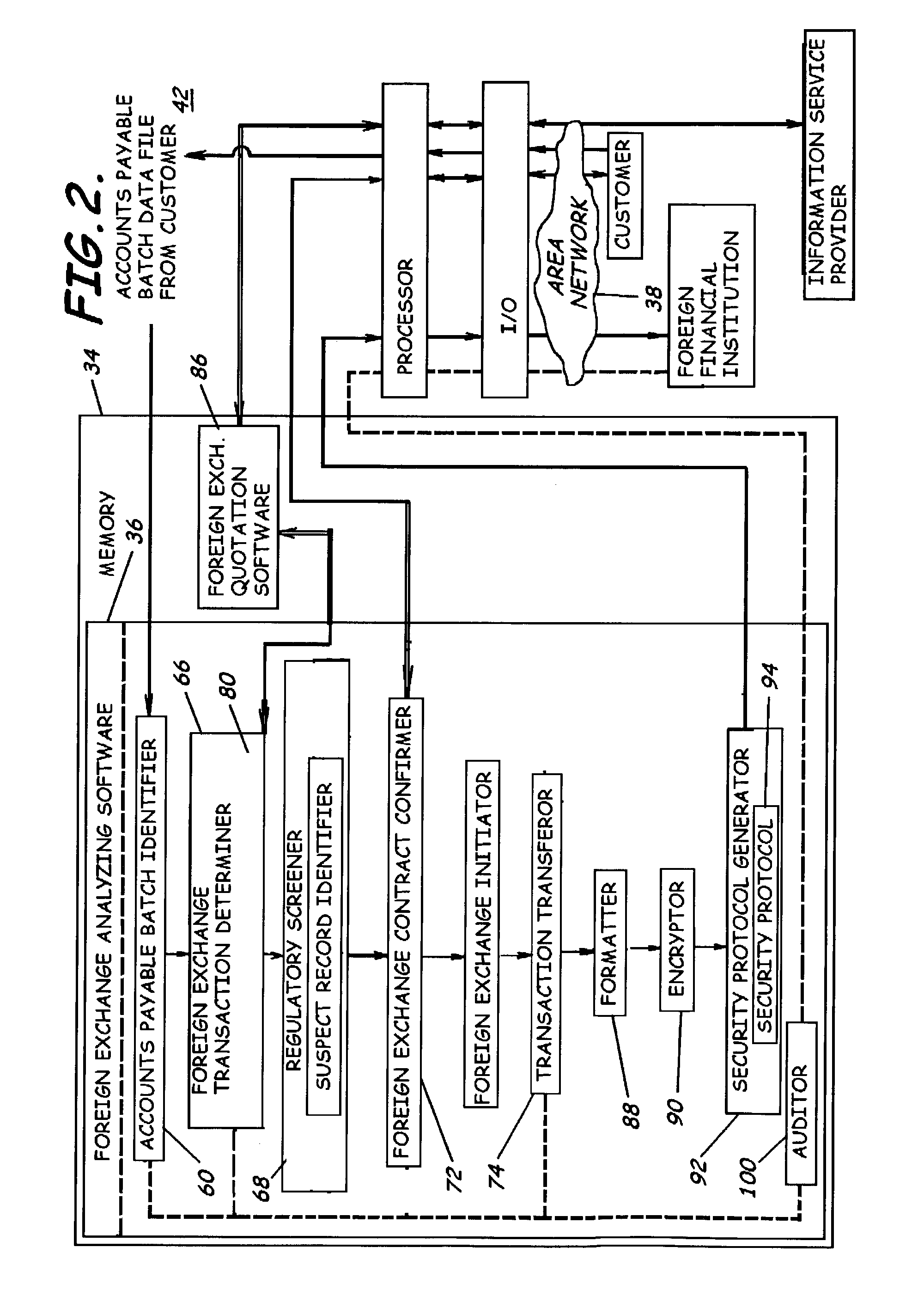

System to facilitate payments for a customer through a foreign bank, software, business methods, and other related methods

InactiveUS7689483B2Speed up the flowReduce exchangeComplete banking machinesFinanceArea networkAccounts payable

A system for facilitating payment of accounts payables from a foreign financial institution for a customer of a domestic financial institution, software, and methods are provided. The system includes a first financial institution computer positioned at a domestic financial institution site to define a domestic financial institution server, having memory associated therewith, and foreign exchange analyzing software stored in the memory of the domestic financial institution server to analyze a foreign exchange transaction. The system also includes an area network in communication with the server, and a second customer computer in communication with the area network, positioned remote from the server at a customer site, and positioned to transmit an accounts payable batch data file having a plurality of accounts payable to the foreign exchange analyzing software stored on the server.

Owner:SOUTHWEST BANK OF TEXAS N A

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com