Patents

Literature

119 results about "Energy market" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Energy markets are commodity markets that deal specifically with the trade and supply of energy. Energy market may refer to an electricity market, but can also refer to other sources of energy. Typically energy development is the result of a government creating an energy policy that encourages the development of an energy industry in a competitive manner.

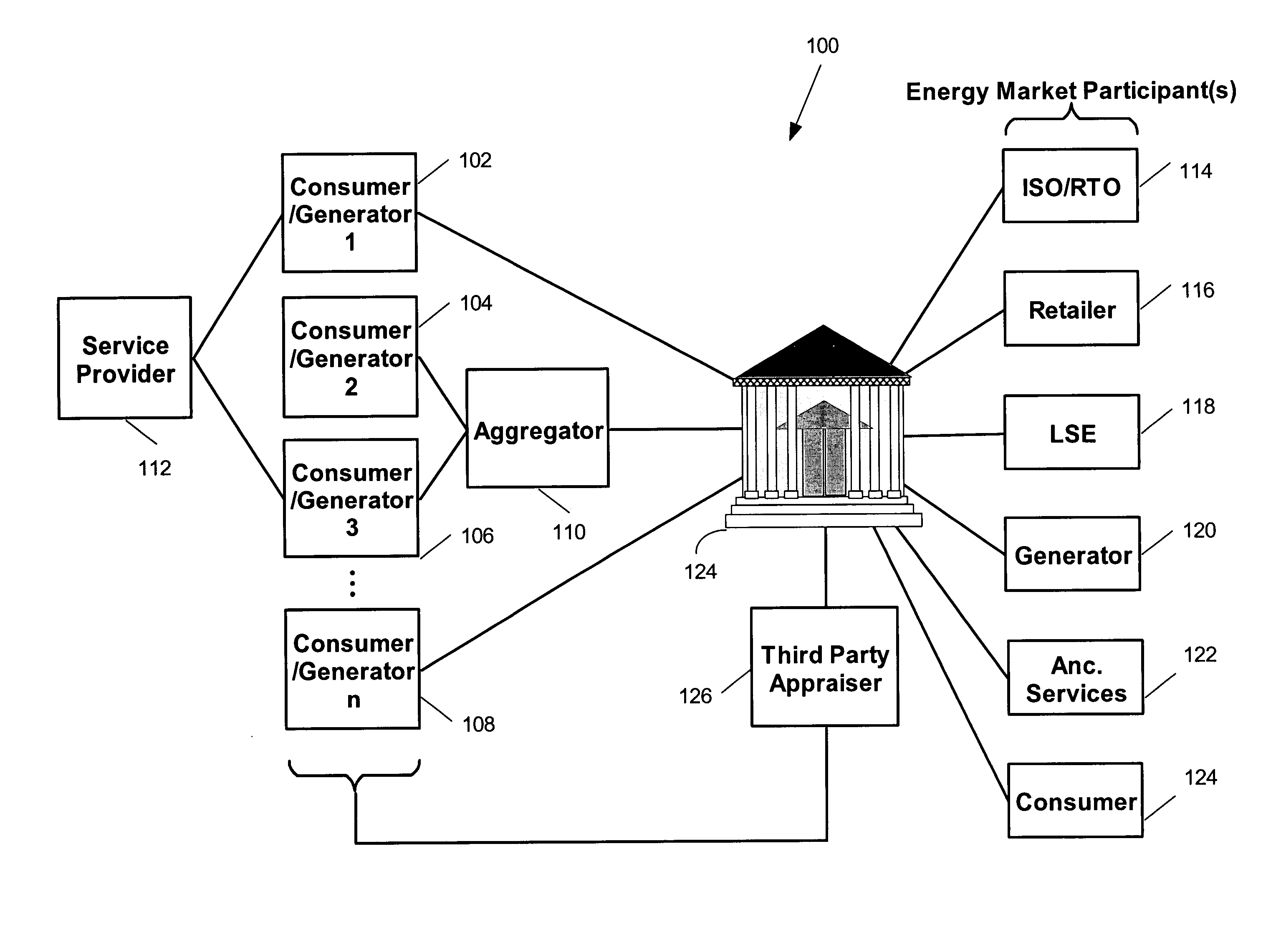

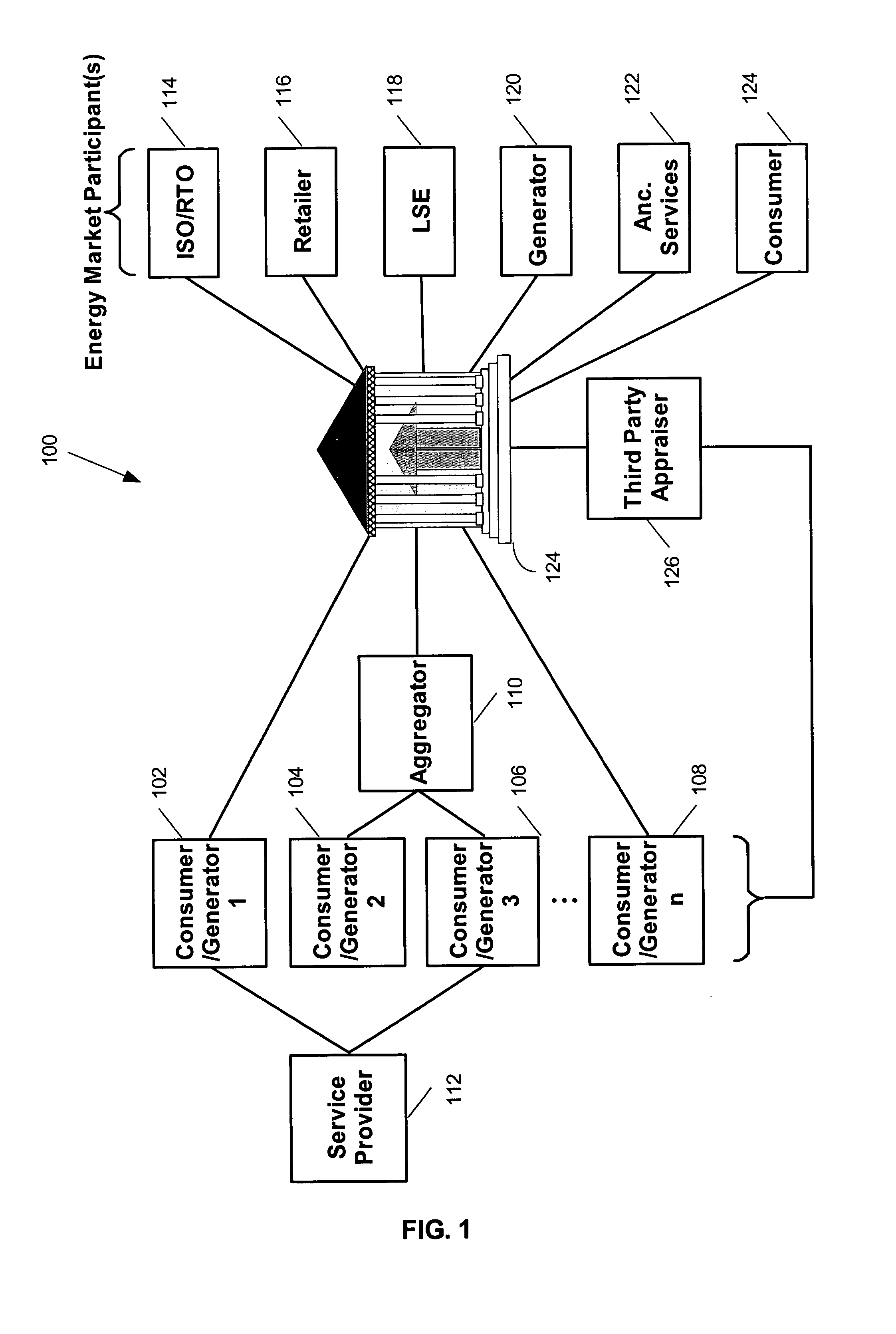

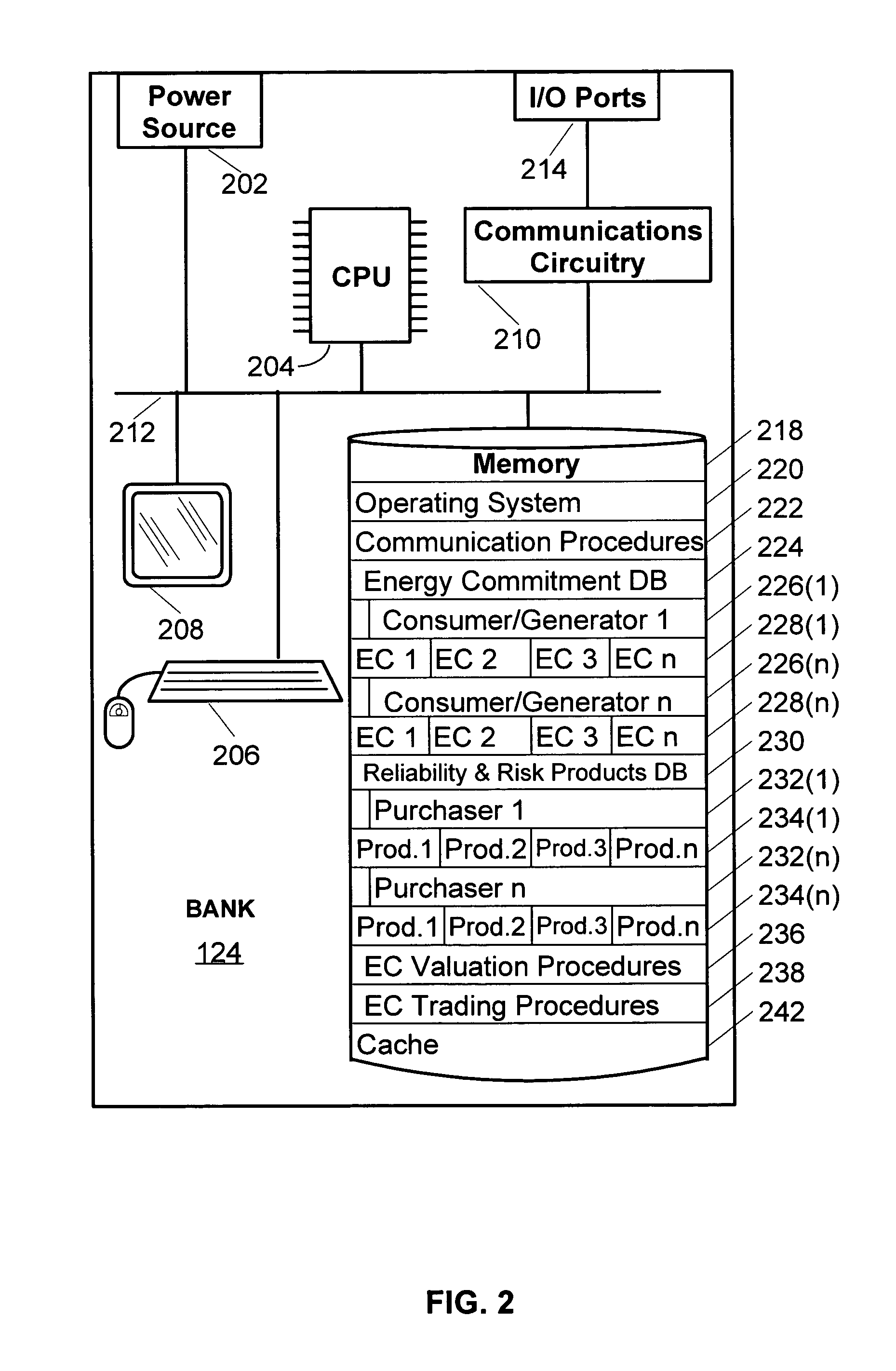

Method and apparatus for trading energy commitments

InactiveUS20050027636A1Reduce and increase energy demandIncrease and reduce energy generationFinanceSpecial data processing applicationsPower stationEnergy supply

The present invention comprises a method, and corresponding system, apparatus and memory for trading energy commitments to reduce or increase energy demand (a demand response commitment), to increase or reduce energy production (a supply response commitment) upon demand or to deliver or to not deliver energy (an energy delivery commitment). Such commitments are made available by energy consumers, energy generators and energy delivery companies, respectively, to an entity that provides consideration for these energy commitments and trades them as fungible commodities to energy market participants. In one embodiment, the present invention comprises a method for trading energy commitments to reduce or increase energy consumption, to increase or reduce energy generation, or to deliver energy, comprising receiving a plurality of multi-year energy commitments; providing consideration for each of the multi-year energy commitments; and trading at least one of the plurality of energy commitments upon demand.

Owner:ELECTRIC POWER RES INST INC

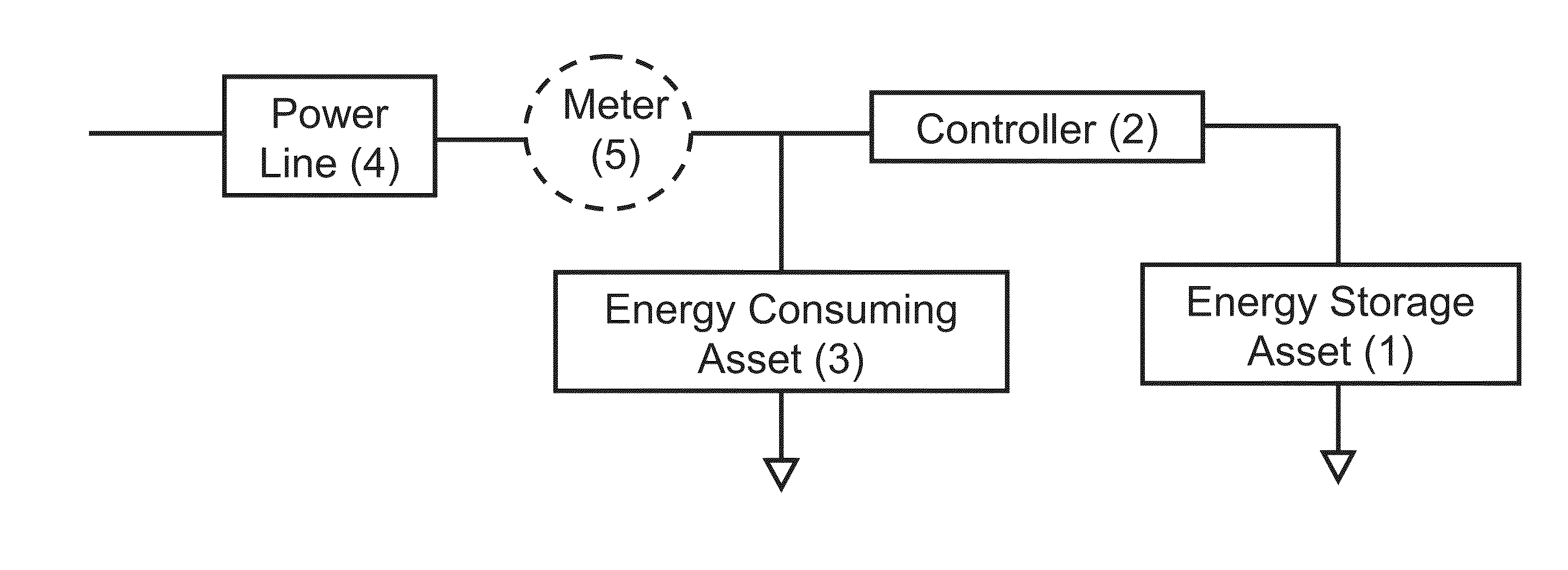

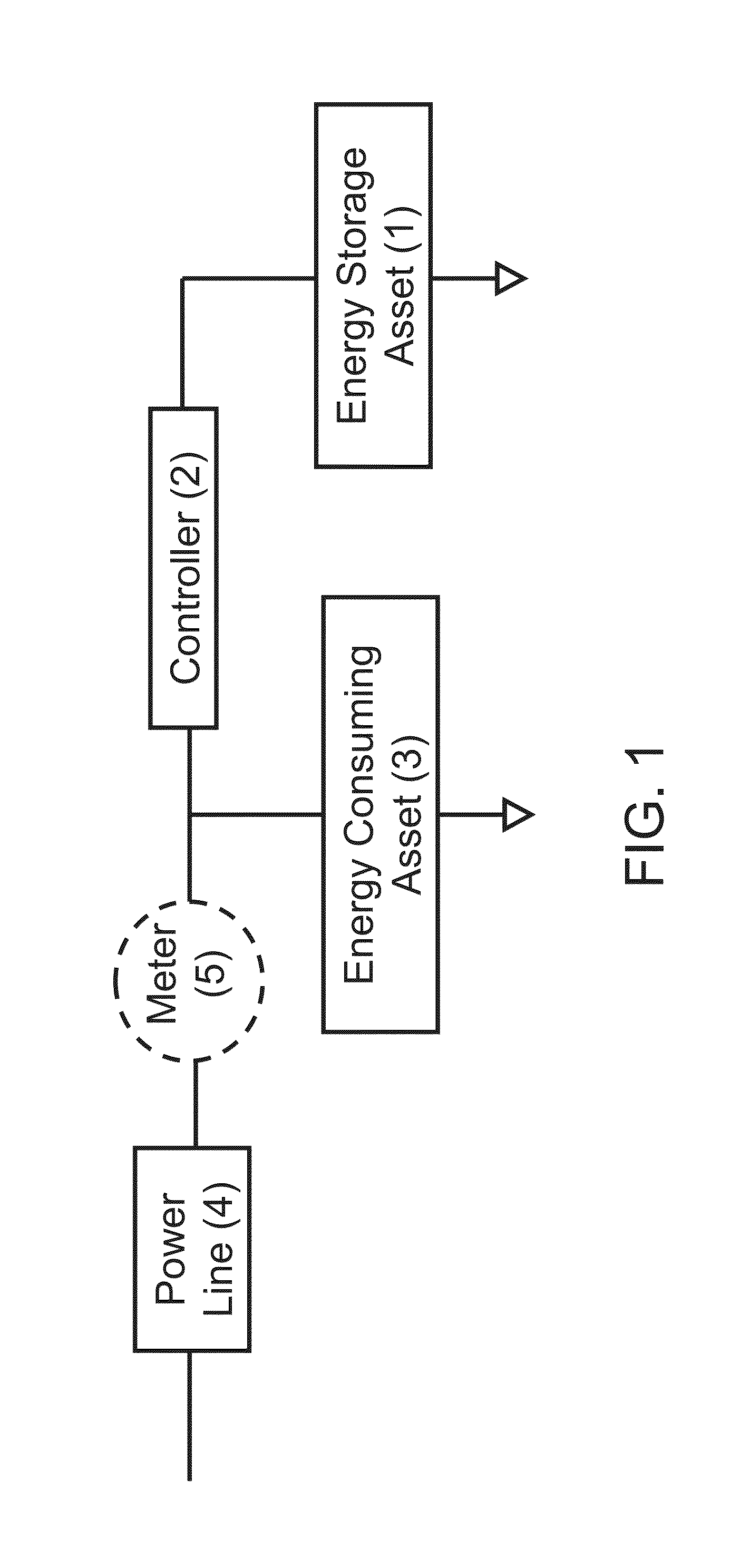

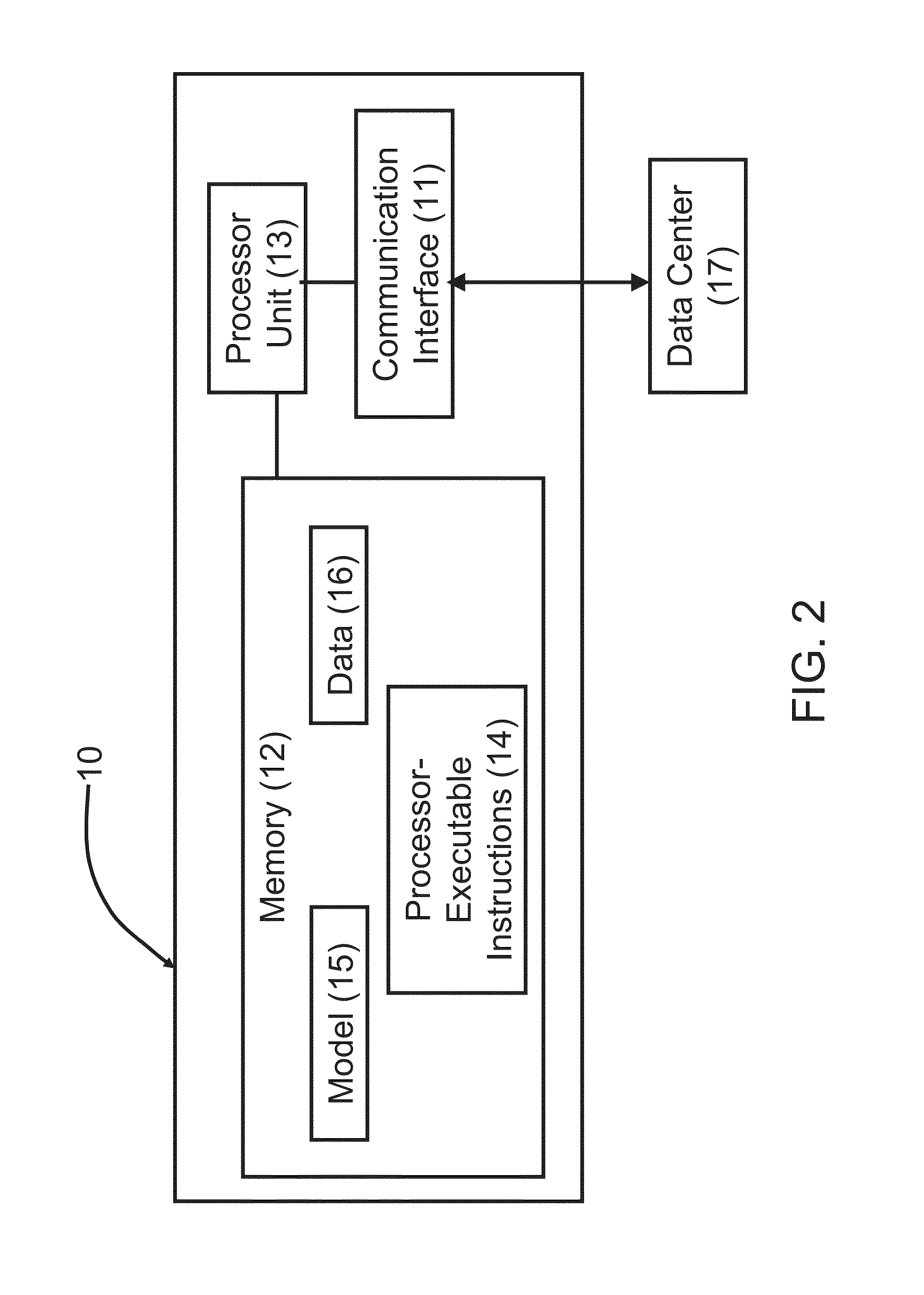

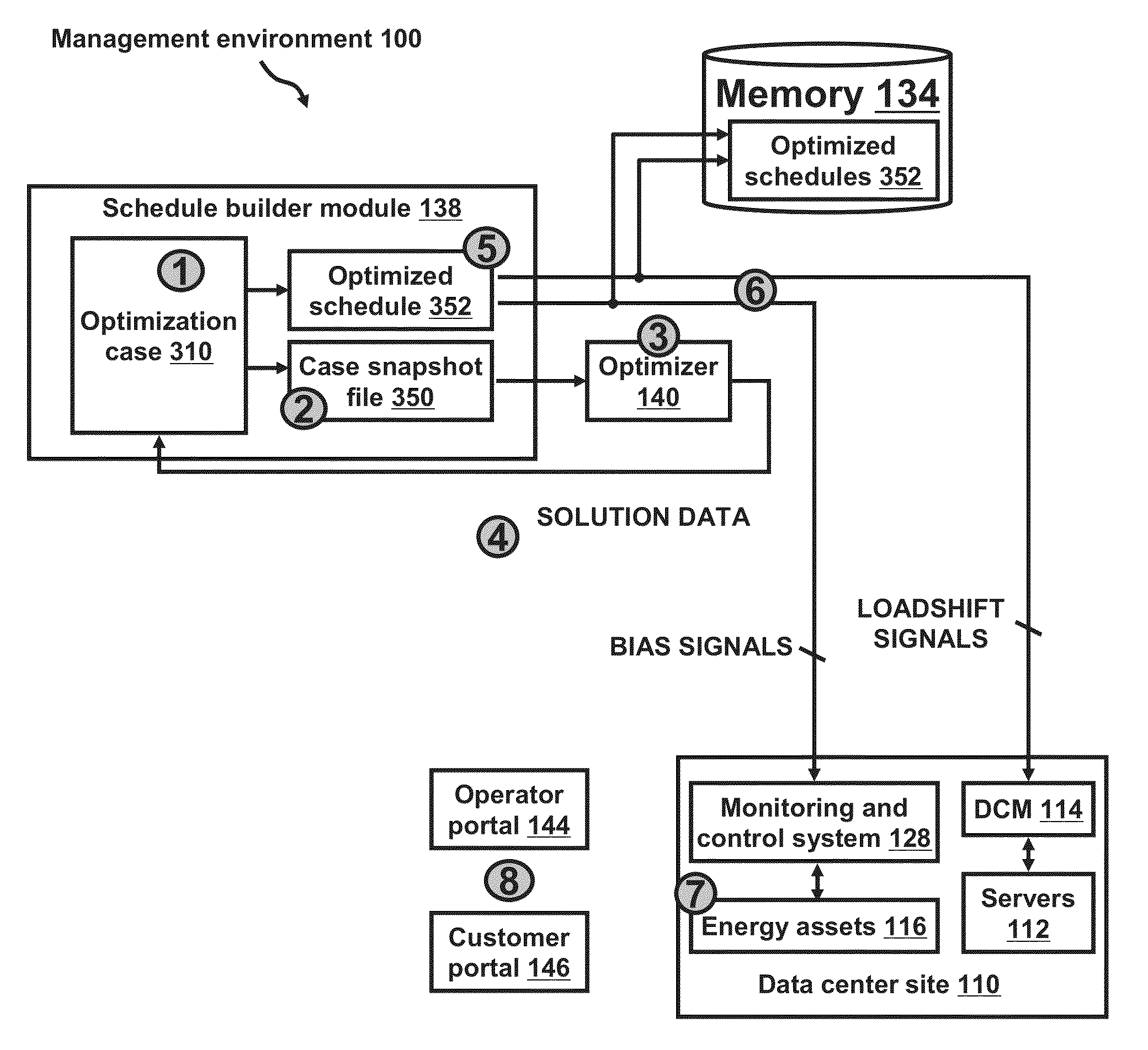

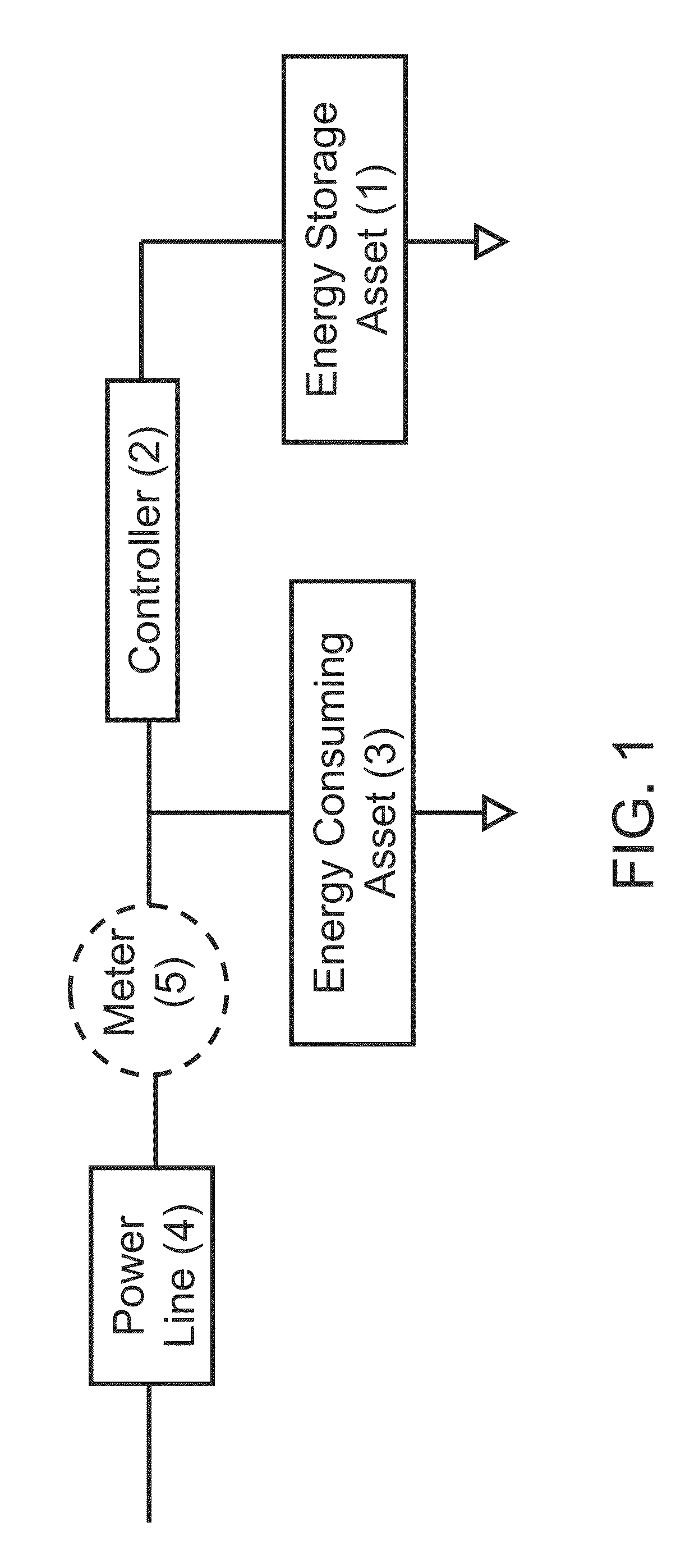

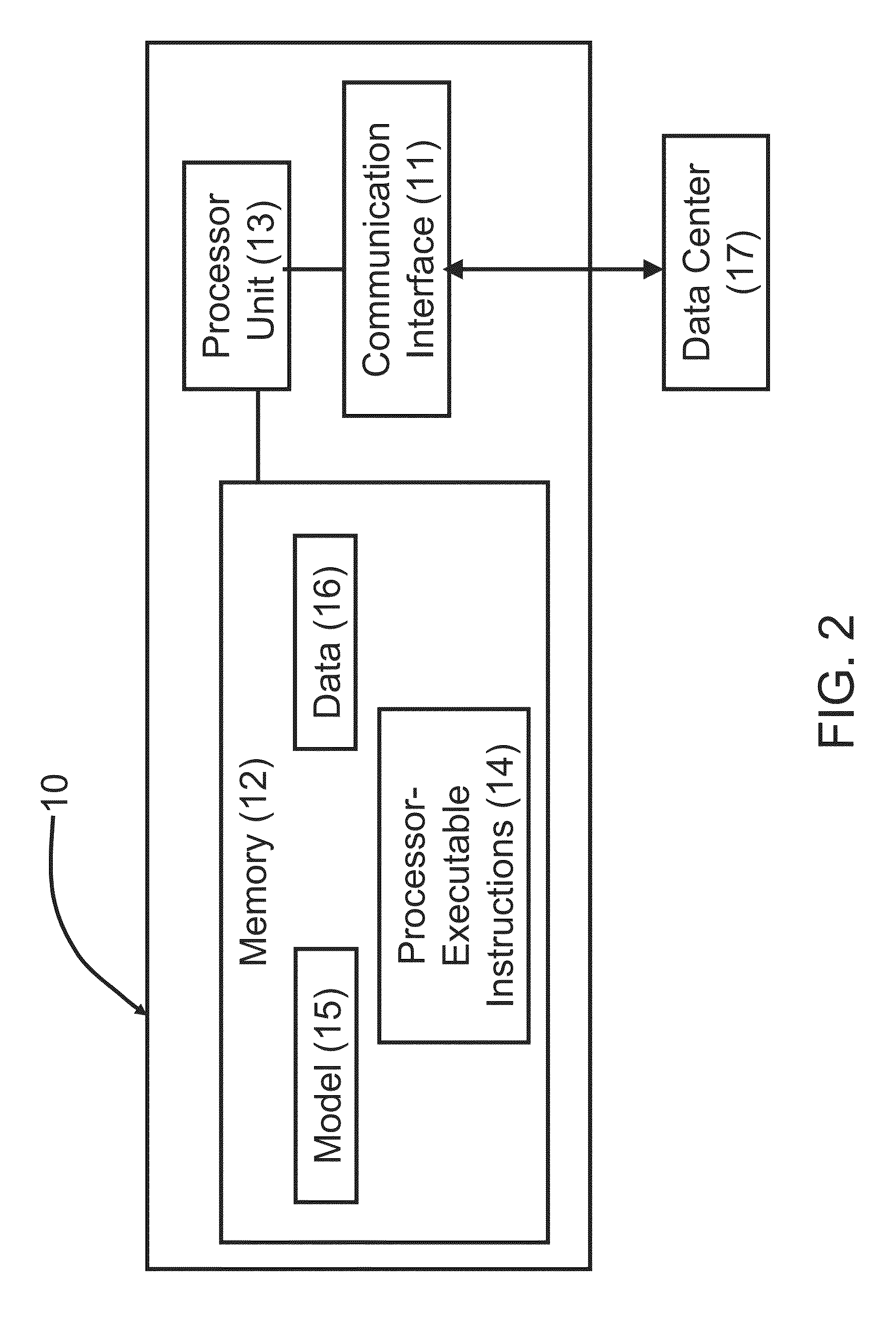

Facilitating revenue generation from data shifting by data centers

InactiveUS20150278968A1More powerLow costMathematical modelsMarket predictionsData centerEngineering

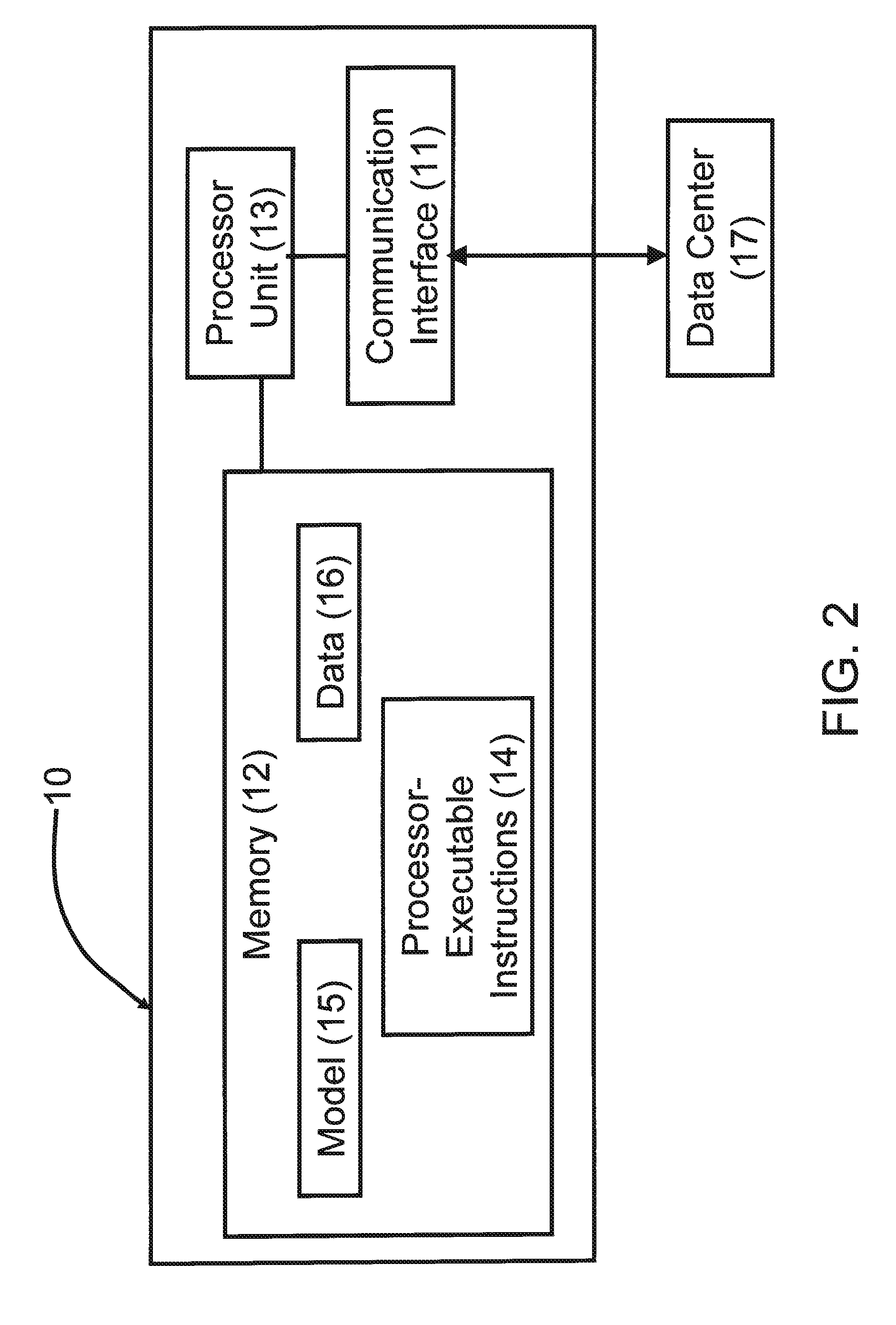

The disclosure facilitates management data center utilization for generating energy-related revenue from energy markets. Operating schedules are generated, over a time period (T), for operation of an energy management system of energy assets of data center sites. Since CPU utilization (or computing load) can be correlated to energy consumption, the operating schedules can cause the energy management system to modulate the CPU utilization (or computing load) of energy assets within a data center, or to indicate shifting of CPU utilization (or computing load) from one data center site in a certain energy market price region to another data center site in a different energy market price region. When implemented, the generated operating schedules facilitates derivation of the energy-related revenue, over a time period (T), associated with operation of the energy assets according to the generated operating schedule.

Owner:VIRIDITY ENERGY SOLUTIONS INC

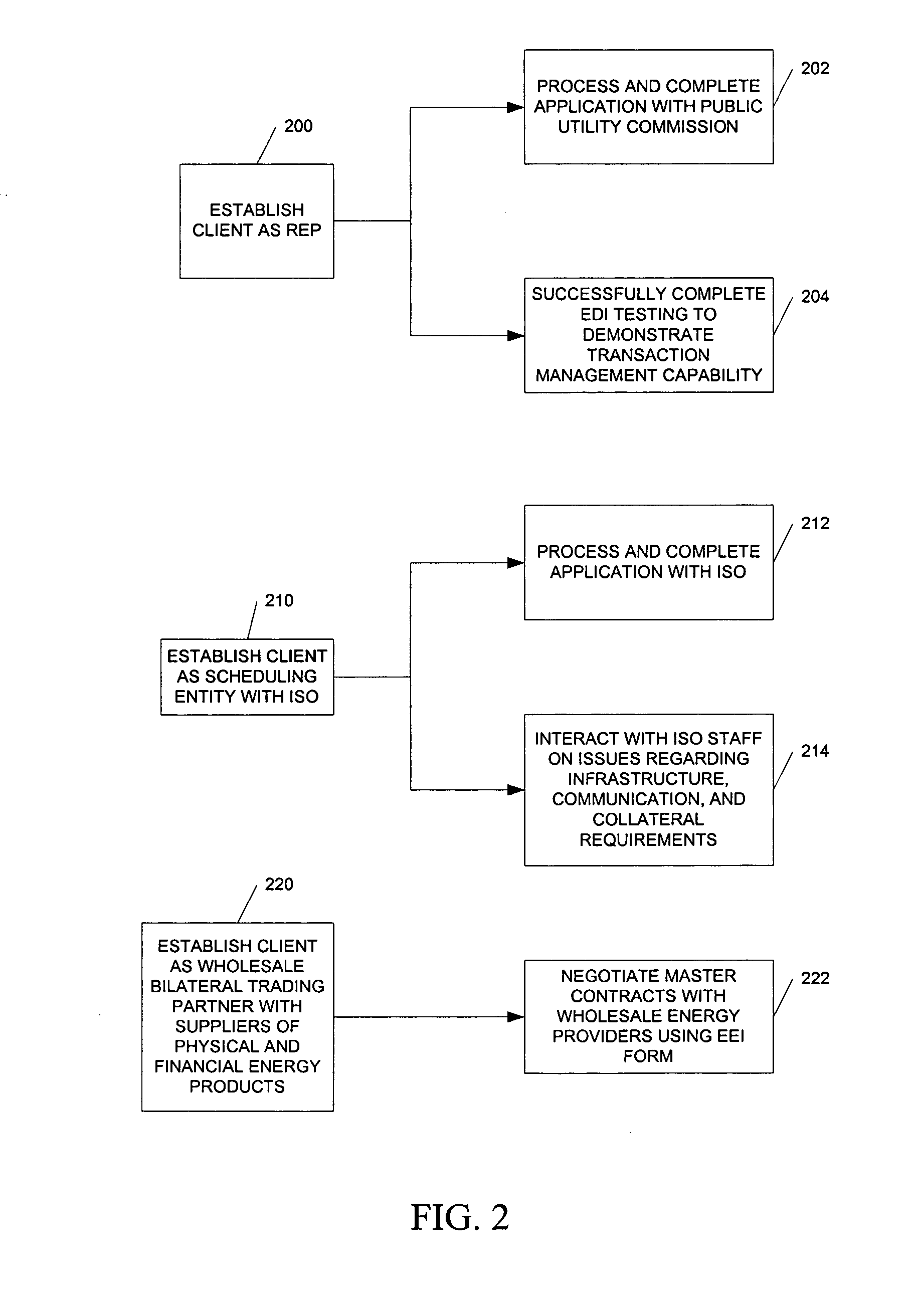

Energy advisory and transaction management services for self-serving retail electricity providers

InactiveUS20050004858A1Reduce energy costsReduce riskFinanceTechnology managementTransaction managementMarket place

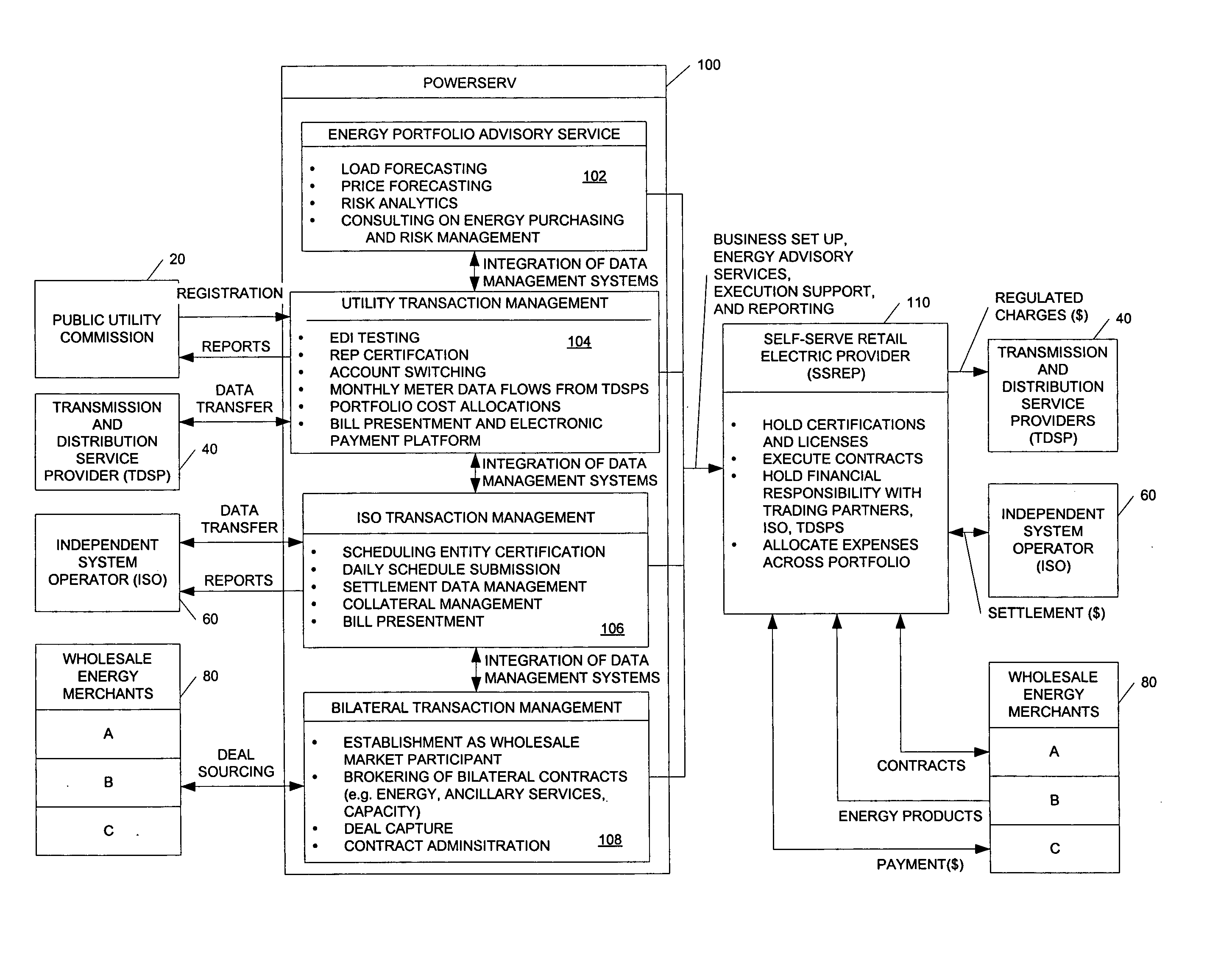

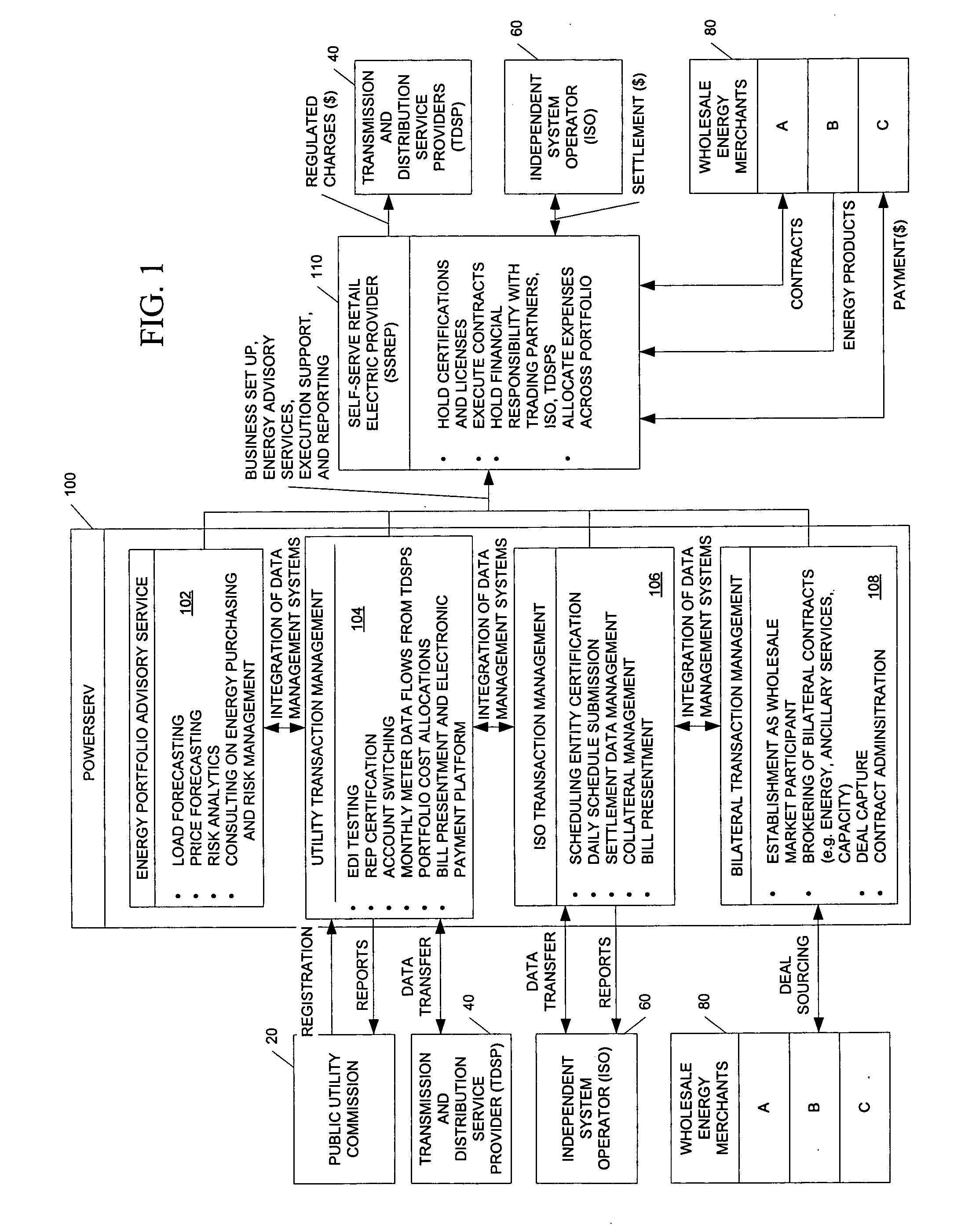

Methods for assisting and enabling a large industrial or business consumer of energy to become a self-serving retail electricity provider in a deregulated energy market. Performed by an energy advisory and transaction management service provider, one method registers the large business energy consumer with the state public utility commission, assists the business to qualify as a scheduling entity with an independent service operator, and establishes the business as a bilateral trading partner of wholesale energy merchants. In another method, the business processing outsourcing service assists the business in energy purchasing and risk management decisions by forecasting zonal load requirements for the business. A price forecasting analysis is compared with supply offers from wholesale energy merchants and bilateral transactions for energy supply are brokered between the business and the wholesale energy merchants. In another method, the business process outsourcing service assists the business to manage electronic transactions with an independent service operator and a transmission and distribution service provider. A daily load forecast for the business is updated and compared with energy purchase commitments to identify imbalances between supply and demand. The outsourcing service submits a daily schedule of forecasted sub-hourly load and purchase and sale commitments to the independent system operator. The outsourcing service receives and processes invoices from market participants and generates financial settlement reports for the business.

Owner:SOUTHERN COMPANY ENERGY SOLUTIONS

Facilitating Revenue Generation From Data Shifting By Data Centers

The disclosure facilitates management data center utilization for generating energy-related revenue from energy markets. Operating schedules are generated, over a time period T, for operation of an energy management system of energy assets of data center sites. Since CPU utilization (or computing load) can be correlated to energy consumption, the operating schedules can cause the energy management system to modulate the CPU utilization (or computing load) of energy assets within a data center, or to indicate shifting of CPU utilization (or computing load) from one data center site in a certain energy market price region to another data center site in a different energy market price region. When implemented, the generated operating schedules facilitates derivation of the energy-related revenue, over a time period T, associated with operation of the energy assets according to the generated operating schedule.

Owner:VIRIDITY ENERGY SOLUTIONS INC

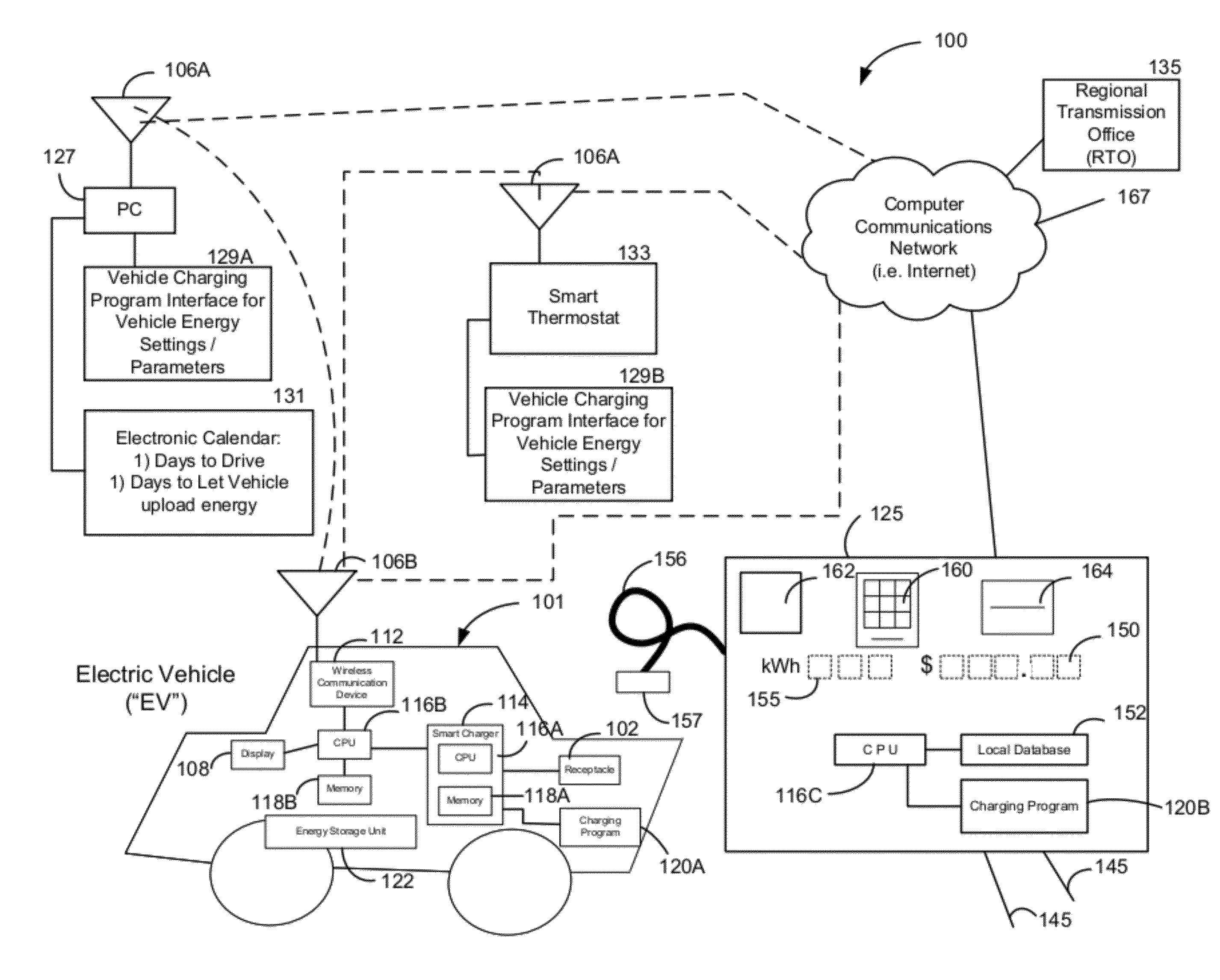

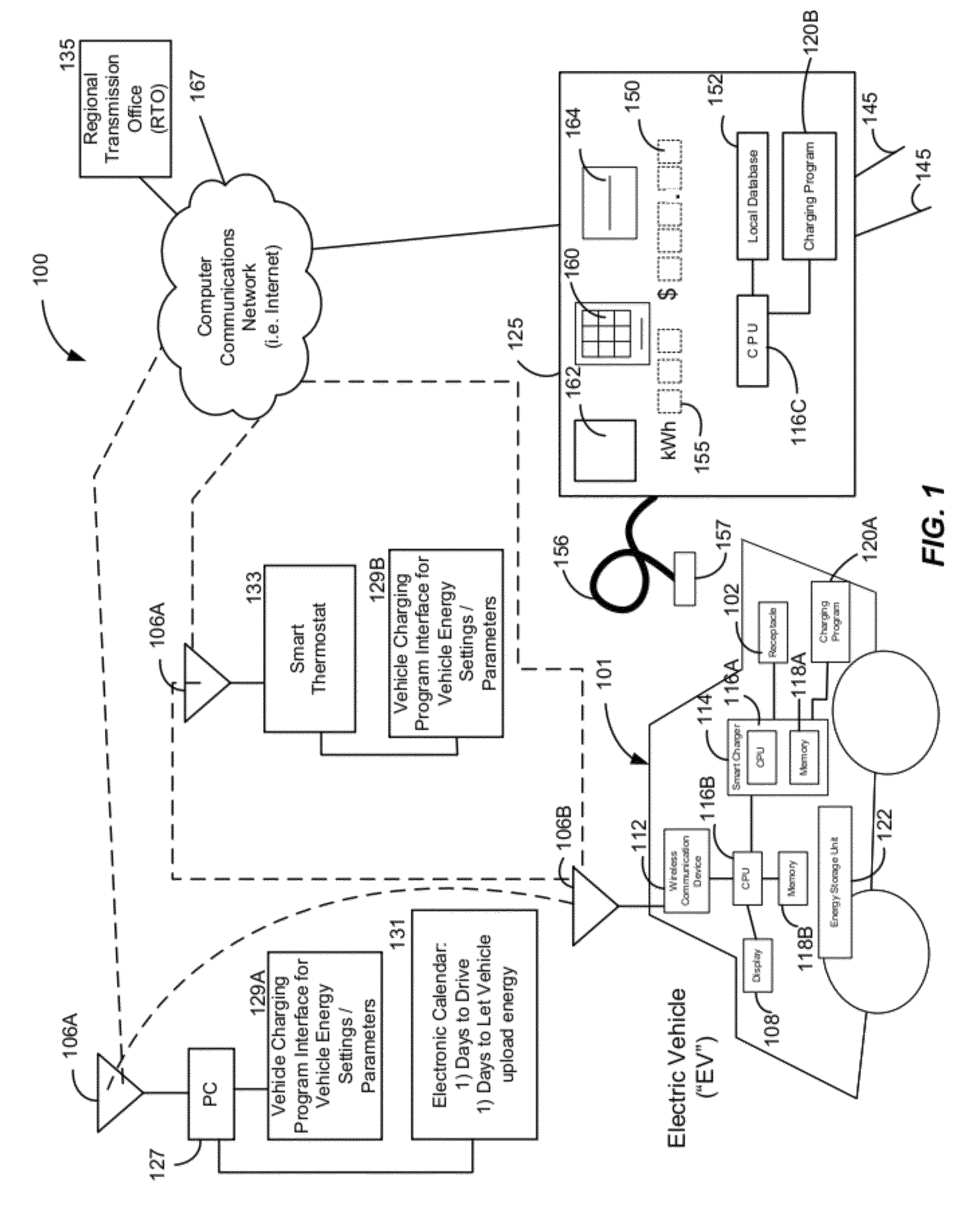

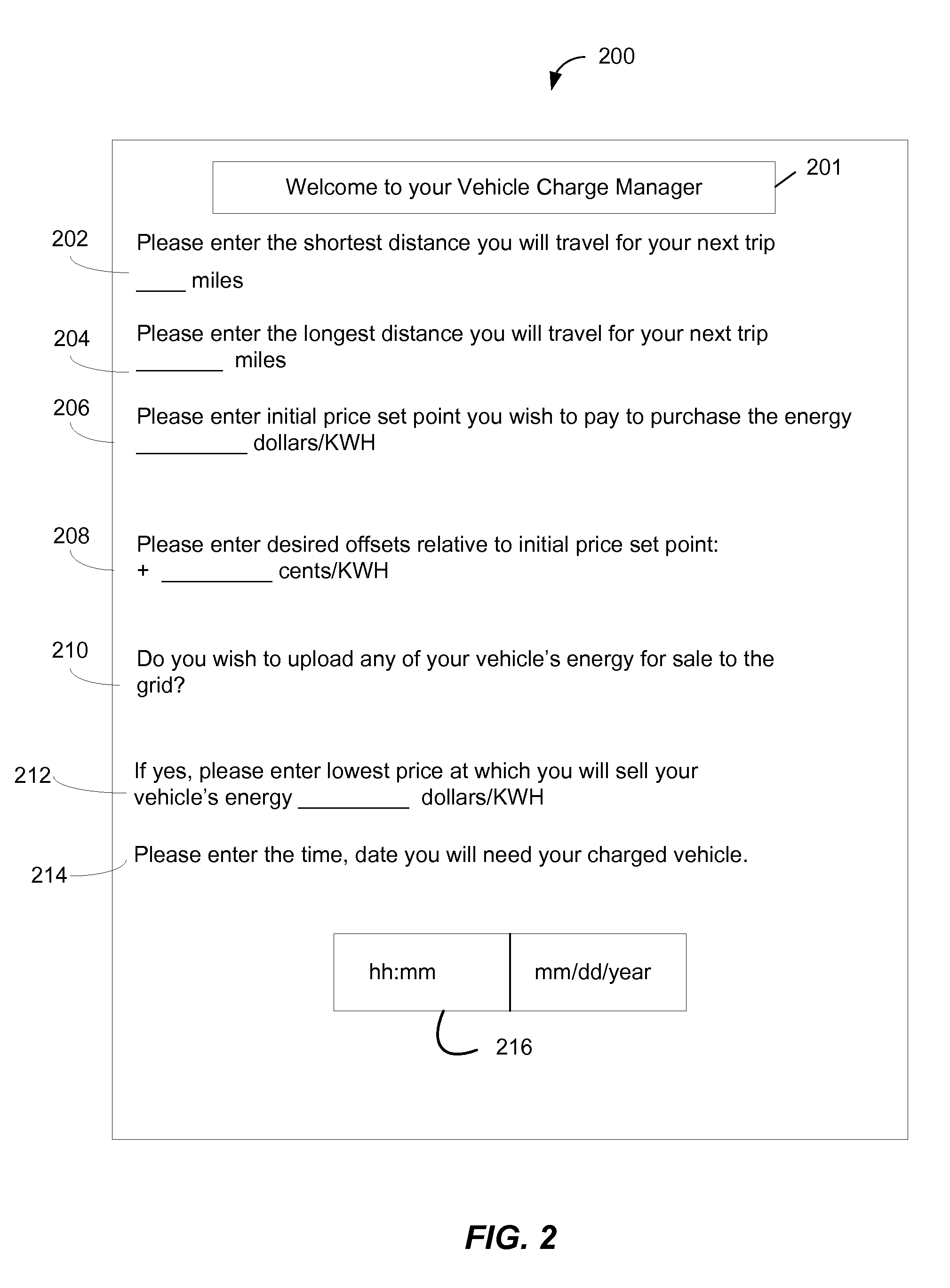

Method and system for charging of electric vehicles according to user defined prices and price off-sets

ActiveUS8154246B1Energy was cheapBatteries circuit arrangementsCharging stationsSimulationPersonal computer

A method and system provides for the charging of electric vehicles according to user defined parameters. The method and system can include an enhanced thermostat, personal computer, and / or an electric vehicle charger which can receive various user defined vehicle charging parameters such as an initial price set point at which to start the charging of an electric vehicle. Another charging parameter can include one or more price offsets relative to the initial set point that can be provided by a user or generated by a computer program. The price offsets allow charging of an electric vehicle at prices above the desired initial price set point when the time remaining to charge an electric vehicle has diminished and the desired initial price set point has not been reached by the energy market. The price offsets can be assigned according to predetermined increments of time, such as an on an hourly basis.

Owner:ITRON

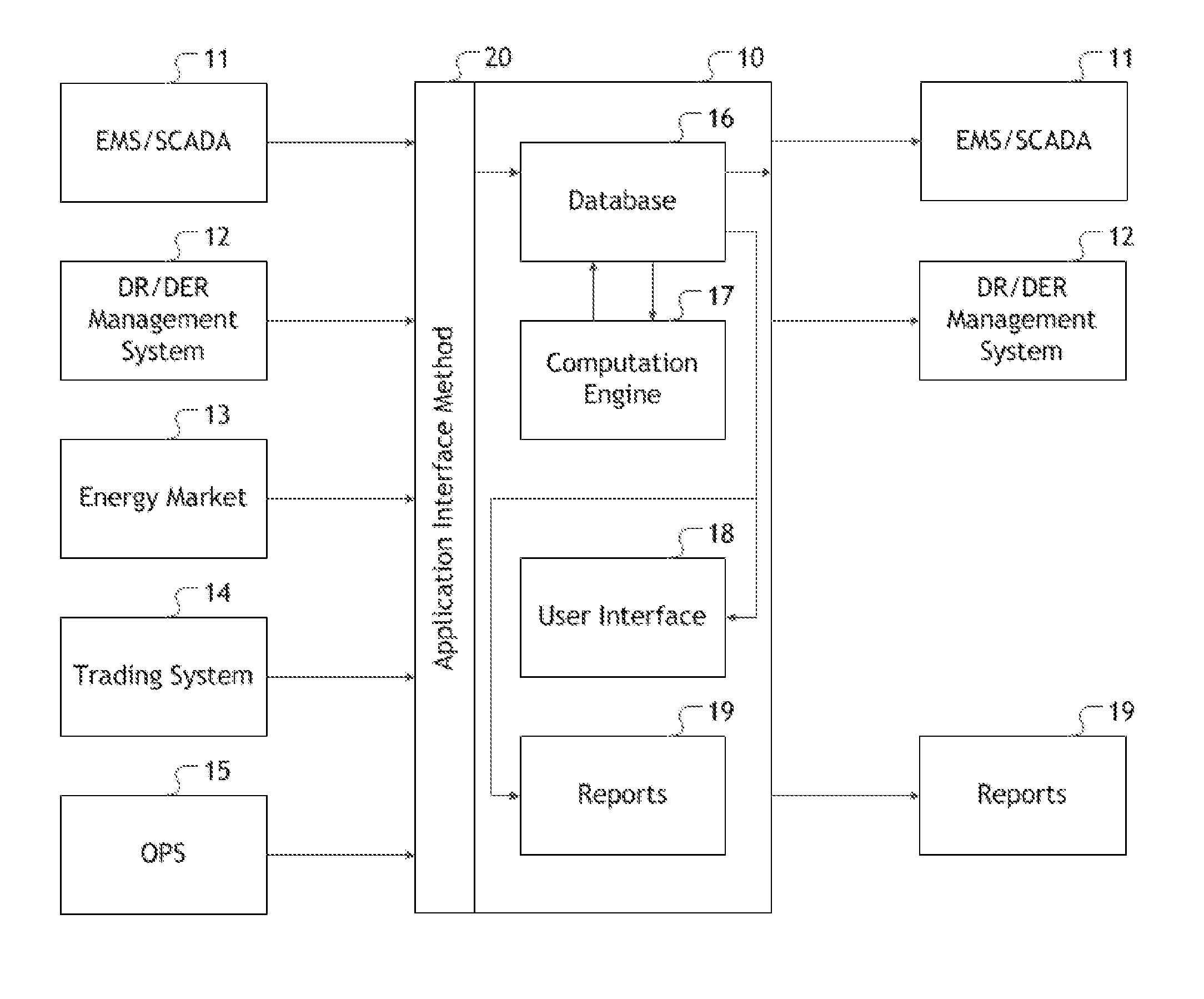

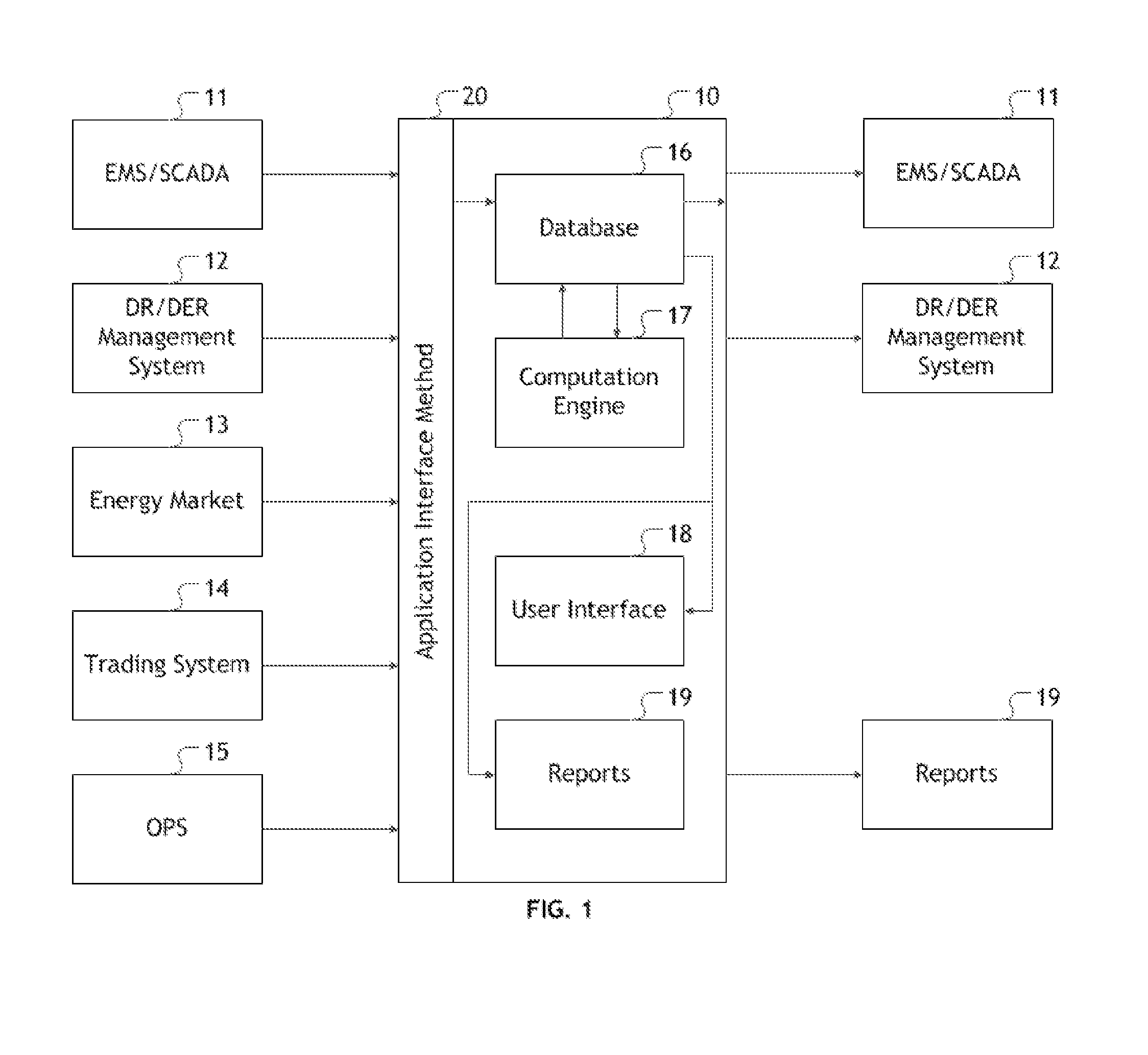

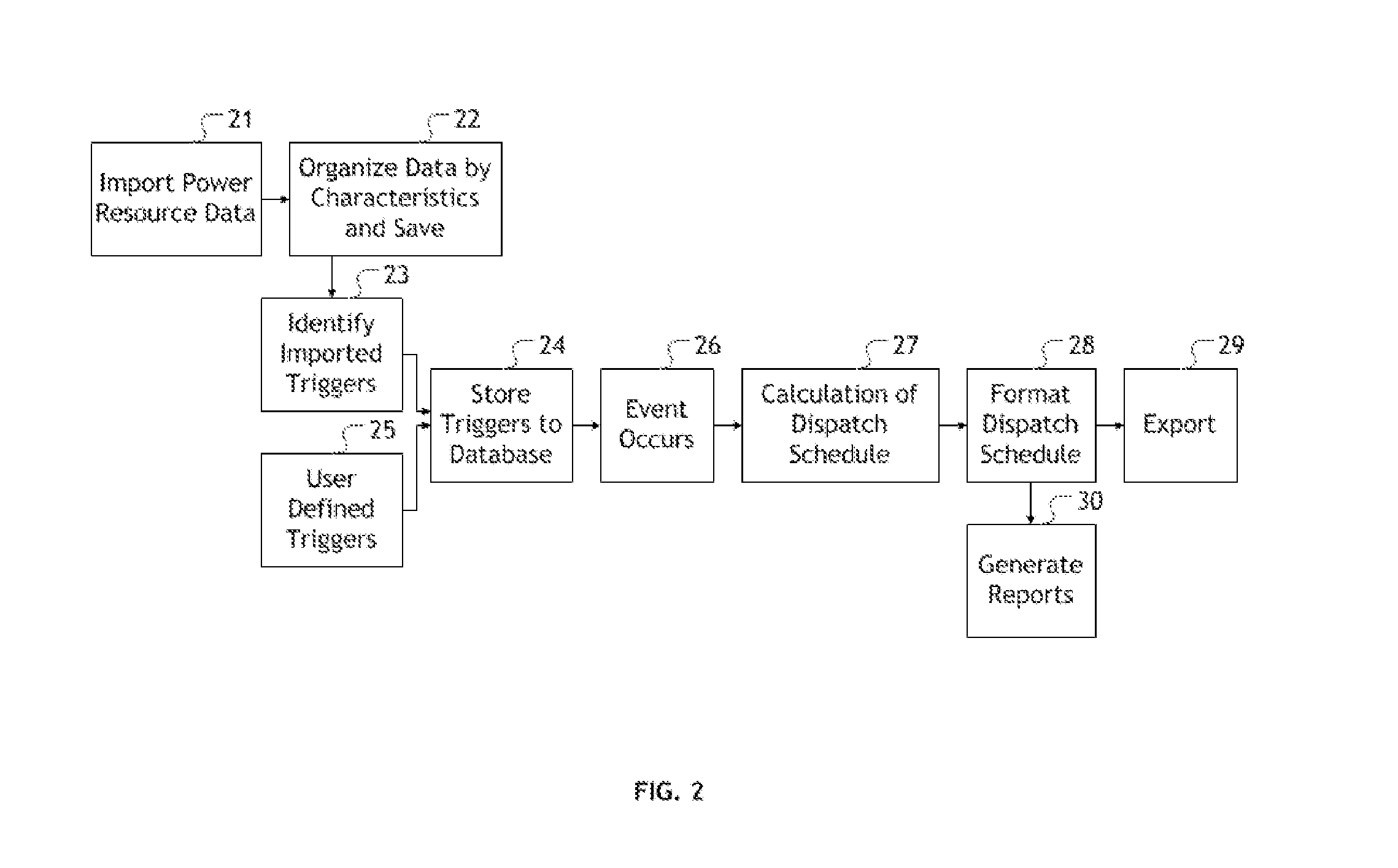

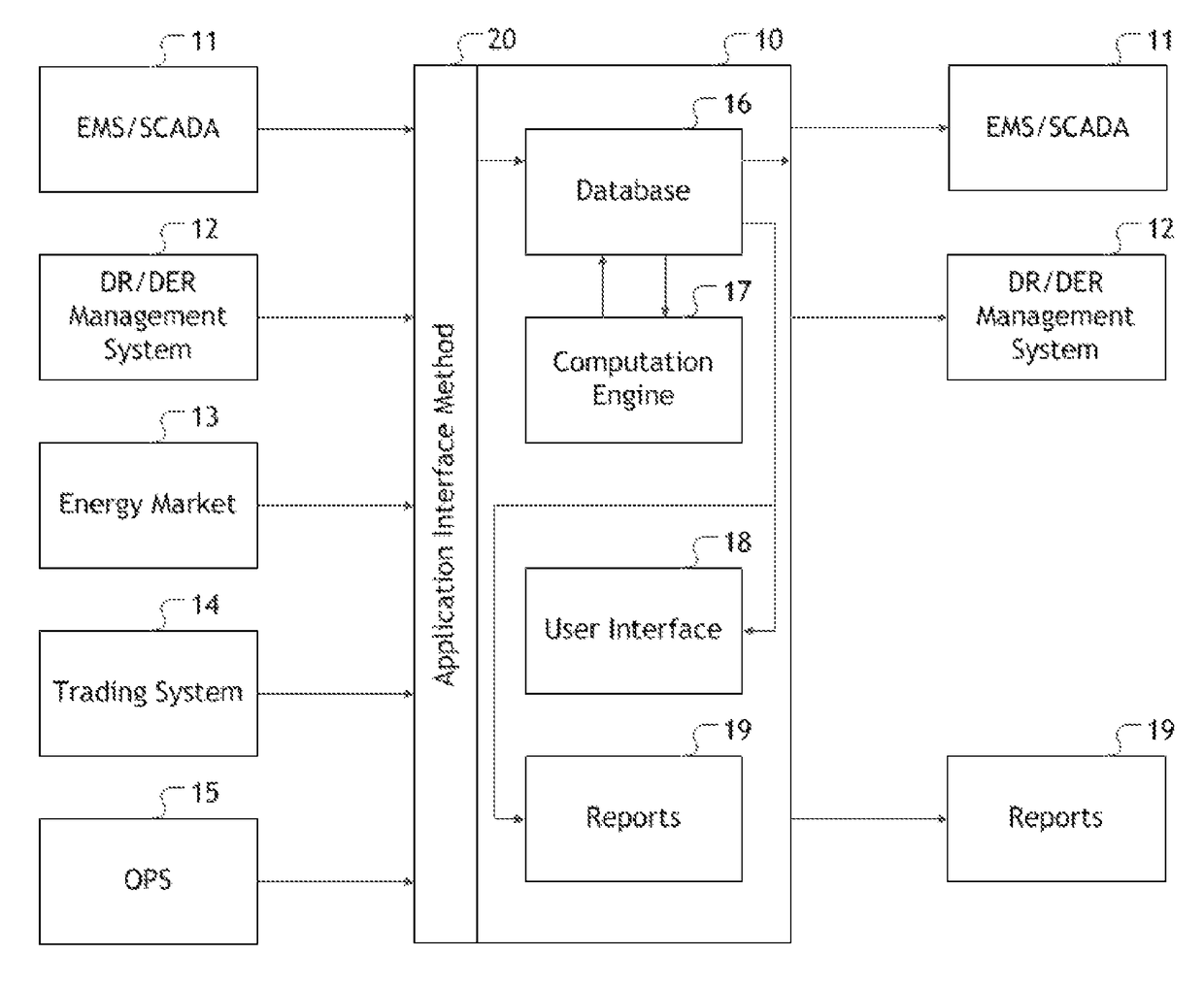

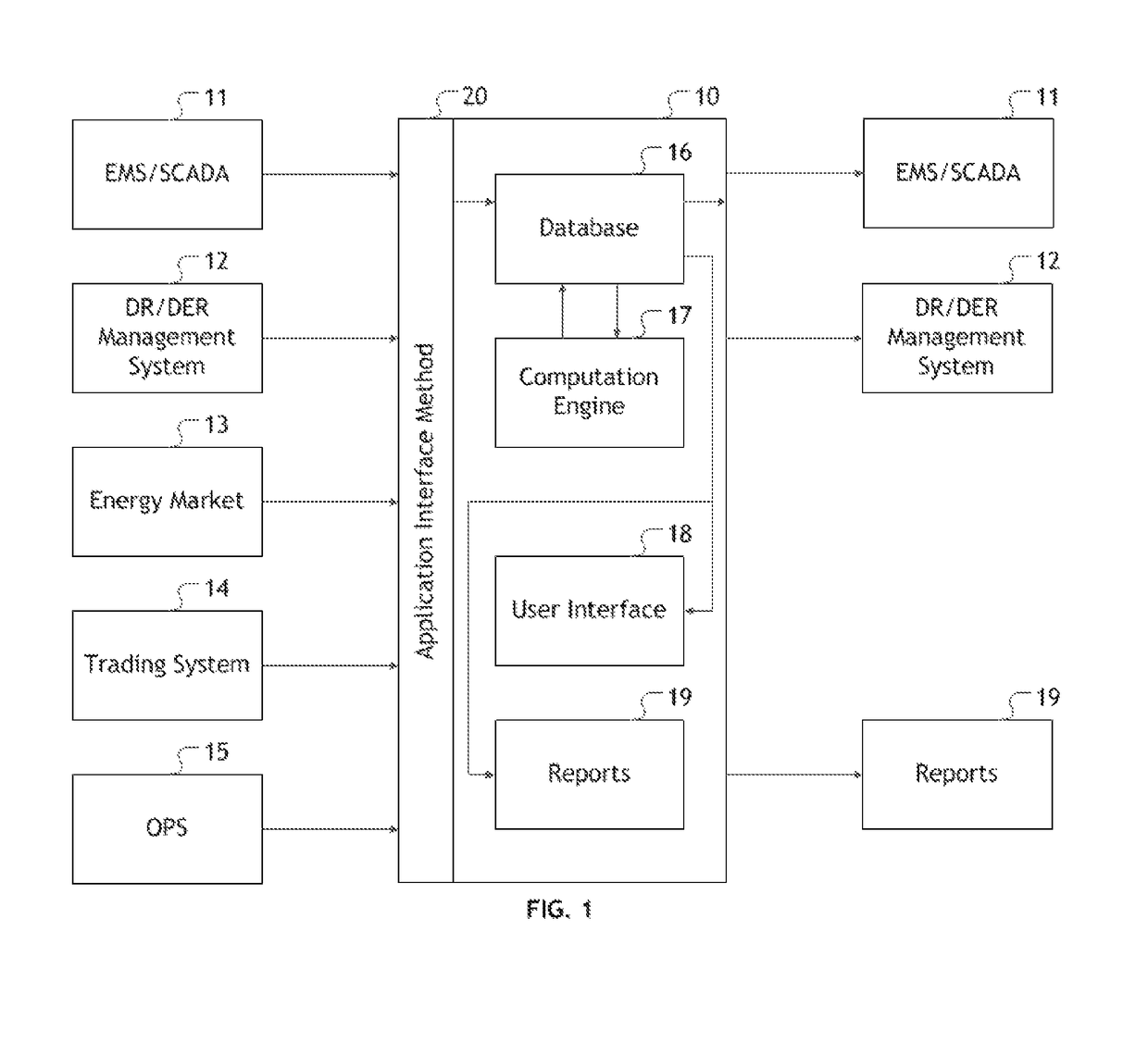

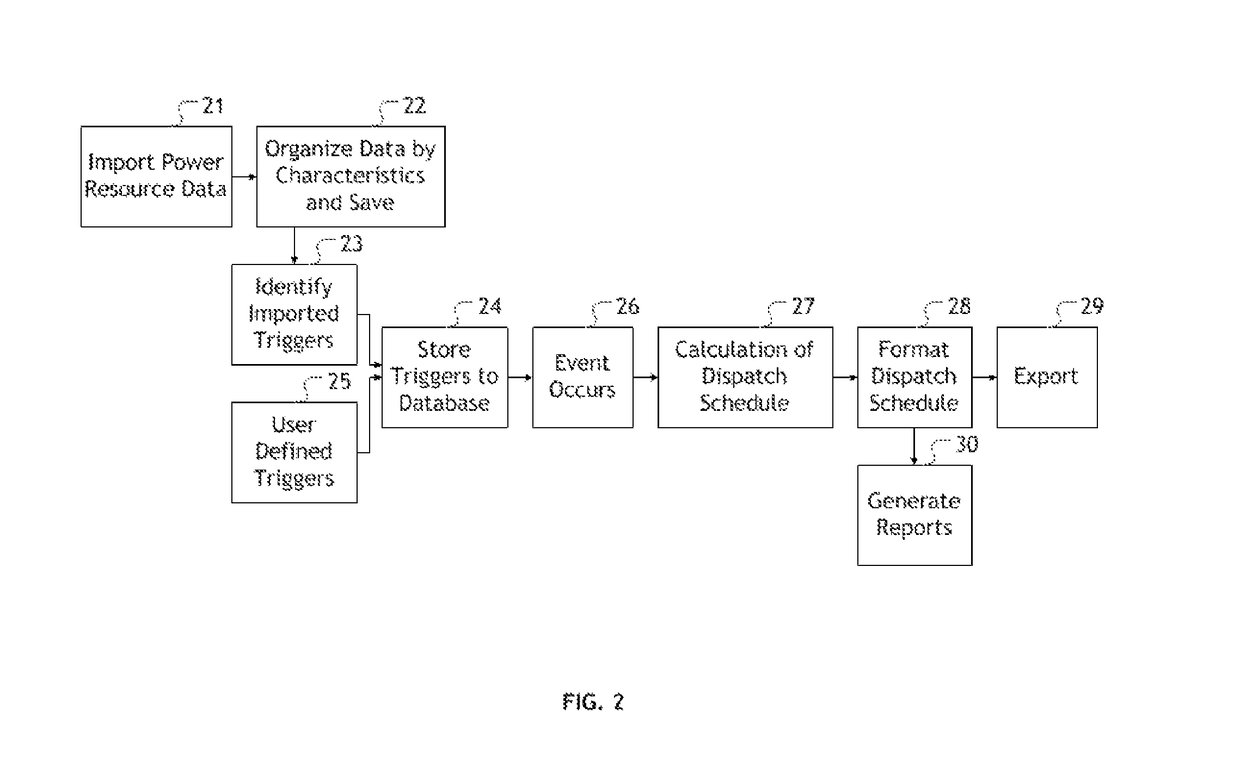

Systems and Methods of Determining Optimal Scheduling and Dispatch of Power Resources

ActiveUS20140277797A1Reduce operating costsLow costMechanical power/torque controlLevel controlData acquisitionMarket based

A system and process / method is provided, which economically optimizes the dispatch of various electrical energy resources. The disclosed process / method is linked to and communicates with various sources of input data, including but not limited to, EMS / SCADA legacy Energy Management Systems (EMS), legacy Supervisory Control and Data Acquisition (SCADA) Systems, Demand Response (DR) and Distributed Energy Resources (DER) monitor, control, schedule, and lifecycle management systems (DR / DER Management System), and Energy Markets, electrical energy commodity trading systems (Trading Systems), and Operations System (OPS) in order to compute optimal day-ahead, day-of, and real-time schedules of various durational length for generation, demand response and storage resources while taking into account bilateral contracts and market-based trade opportunities.

Owner:OPEN ACCESS TECH INT

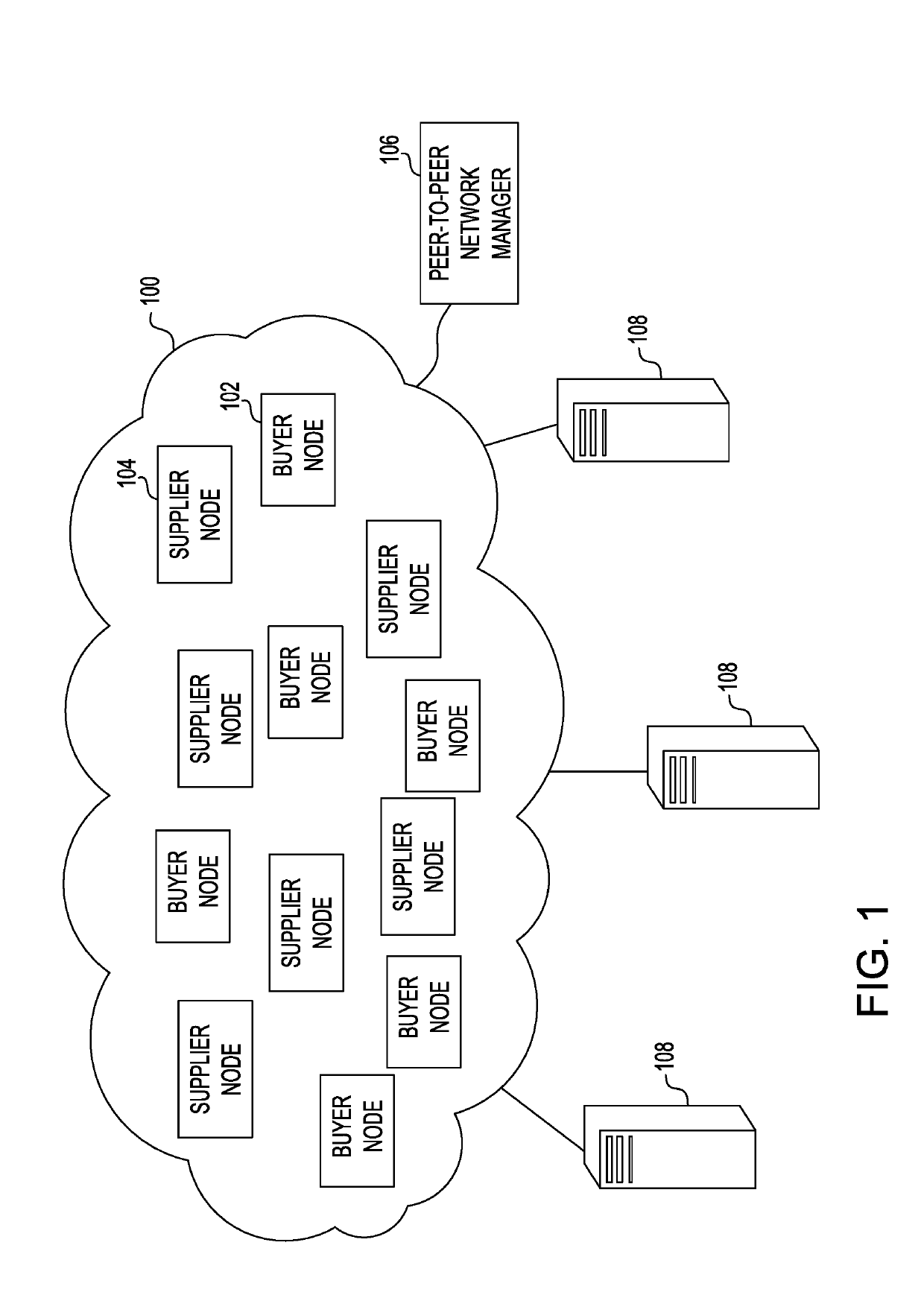

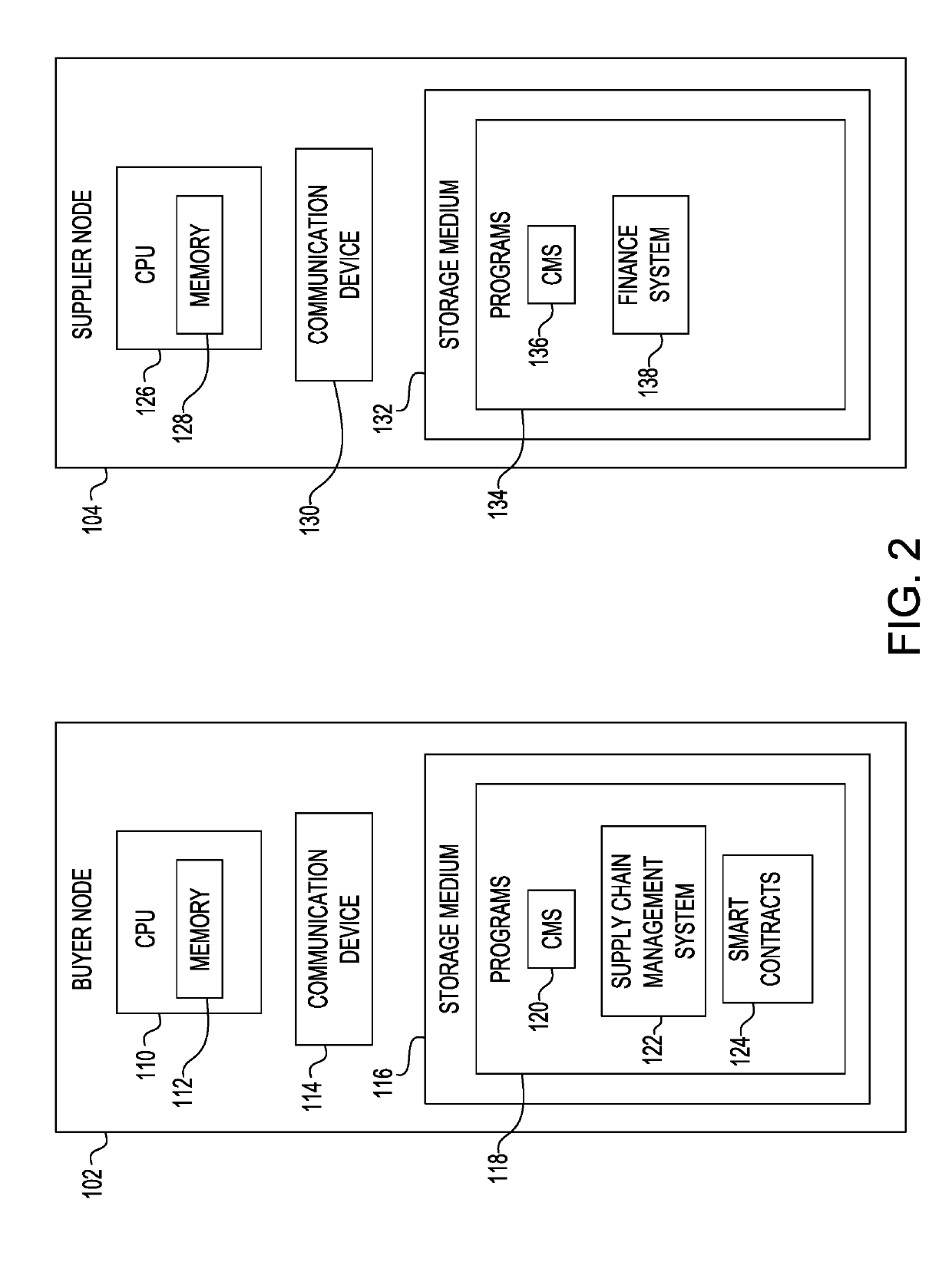

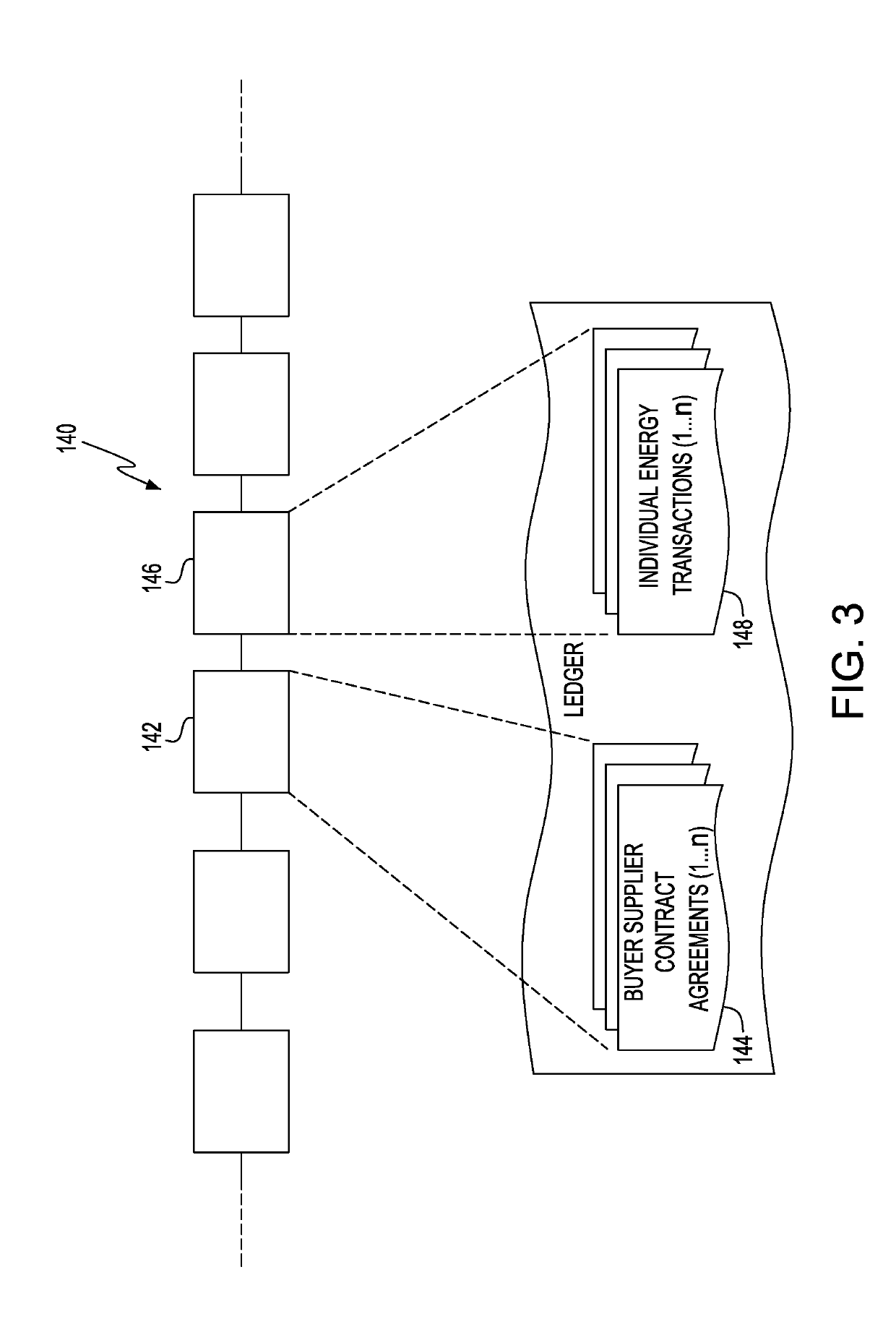

Managing energy purchase agreements on a blockchain

ActiveUS20190165931A1Encryption apparatus with shift registers/memoriesCryptography processingEnergy supplyProcess engineering

A computer-implemented method of managing energy supply agreements that includes: connecting to a permissioned blockchain, the blockchain being accessible only by energy suppliers, energy transmission companies and government agencies that regulate a market for the supply of energy by energy suppliers to energy transmission companies; creating a new block for an energy purchase agreement that provides for the purchase of energy by an energy transmission company from an energy supplier; appending the new block having the energy purchase agreement to the blockchain; and responsive to the energy supplier supplying a quantity of energy to the energy transmission company in an individual energy transaction, appending the individual energy transaction as a block to the blockchain.

Owner:IBM CORP

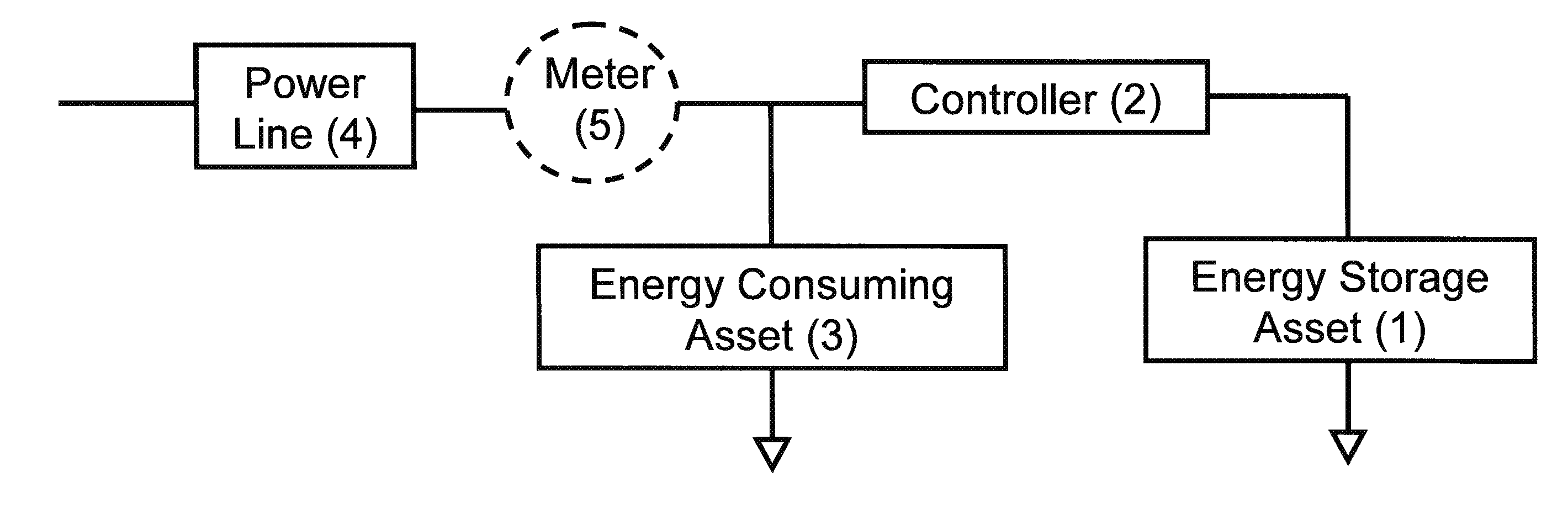

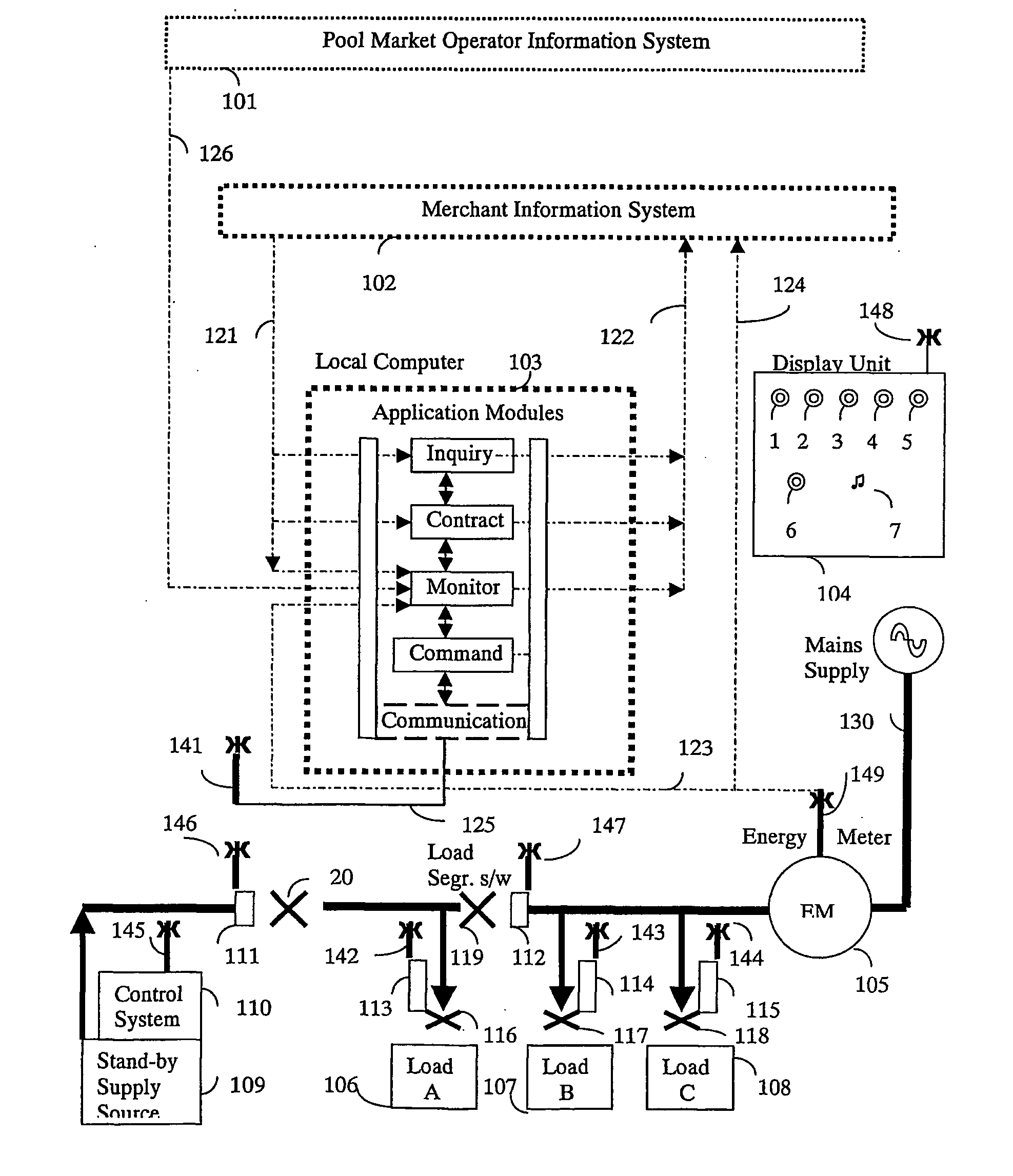

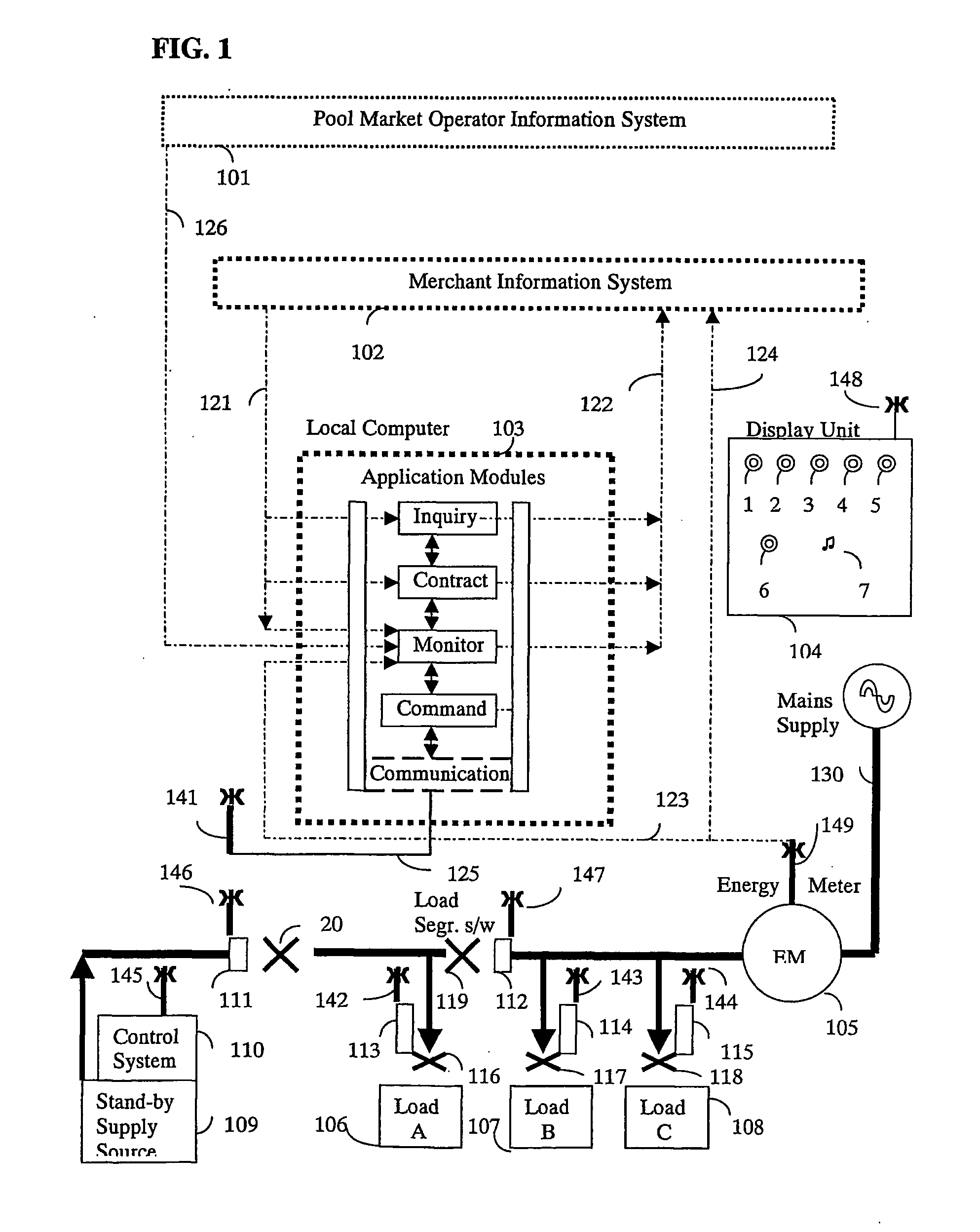

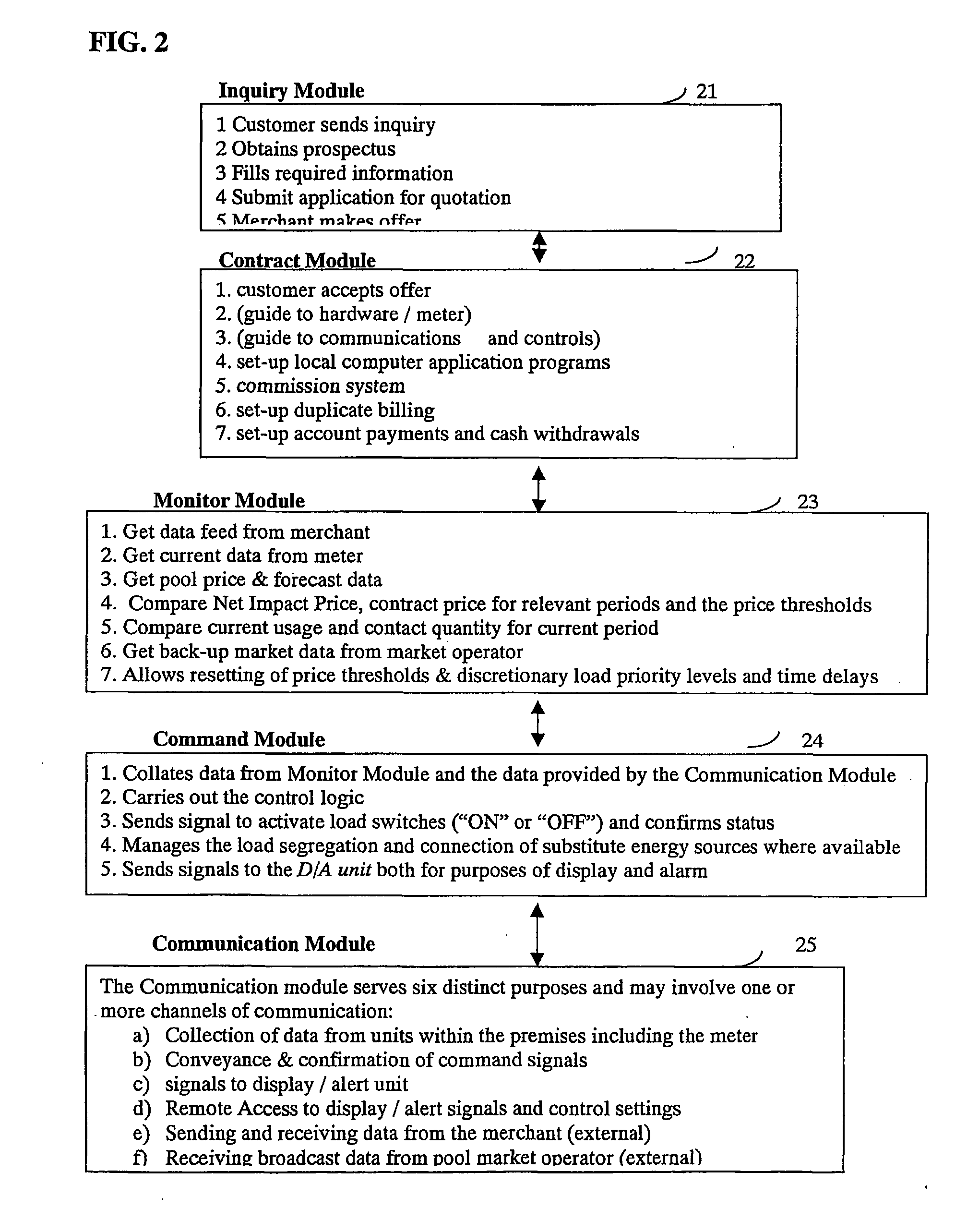

Method to enable customers to respond to prices in a pool type energey market

InactiveUS20040220869A1FinancePower network operation systems integrationMarket placeProcess engineering

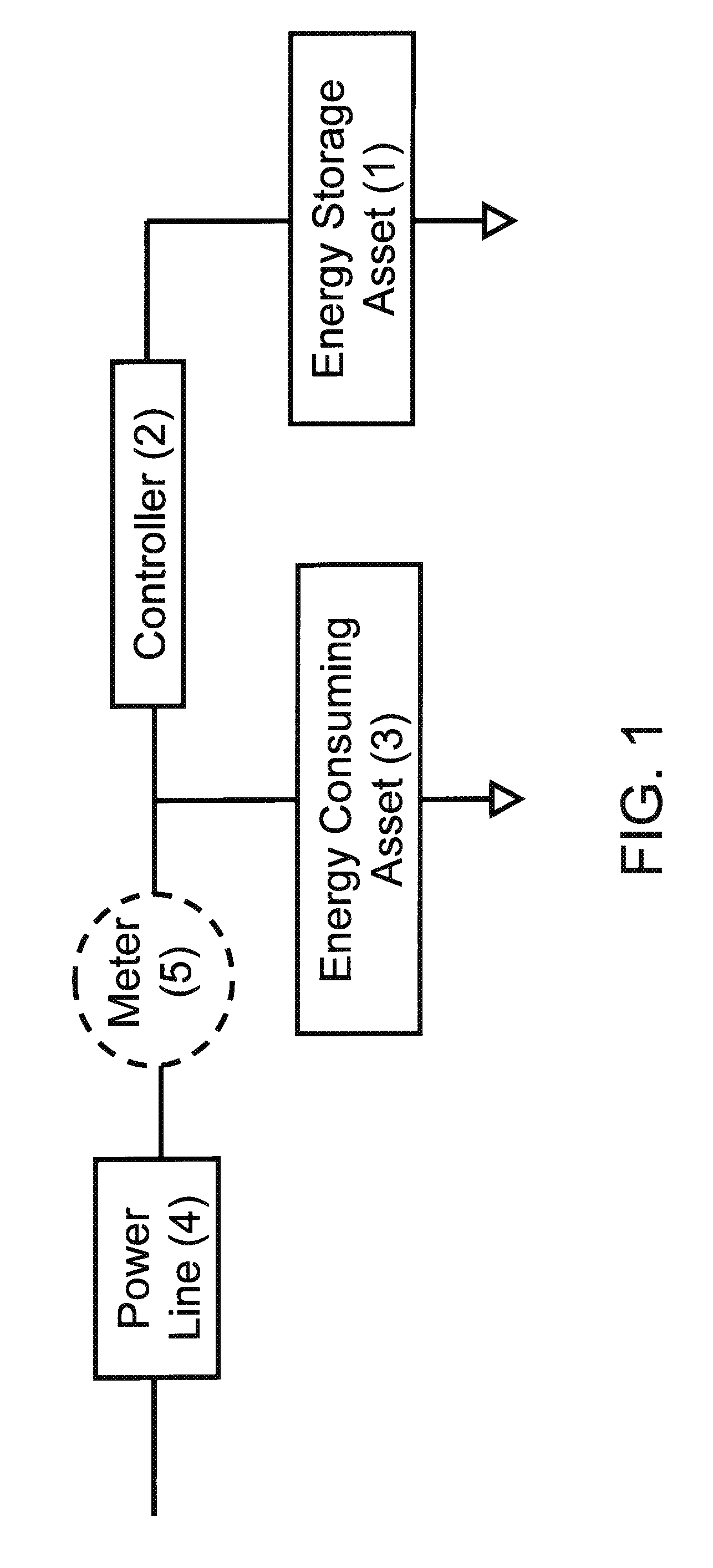

A merchant and a customer have an agreement for the trading of energy units wherein the customer pays a contracted sum and the applicable wholesale market pool price for excess units of energy and receives the wholesale market pool price for unused units of energy. A system monitors and controls the energy usage of the customer. The system includes a metering means (105), a communication means (123, 124) receiving pricing information, a computing means (103) accumulating information from the metering means and communication means and determining a preferred trading outcome, and switching means controlling energy supply to the energy consuming devices to achieve the preferred trading outcome.

Owner:PERERA ANIL LASANTHA MICHAEL

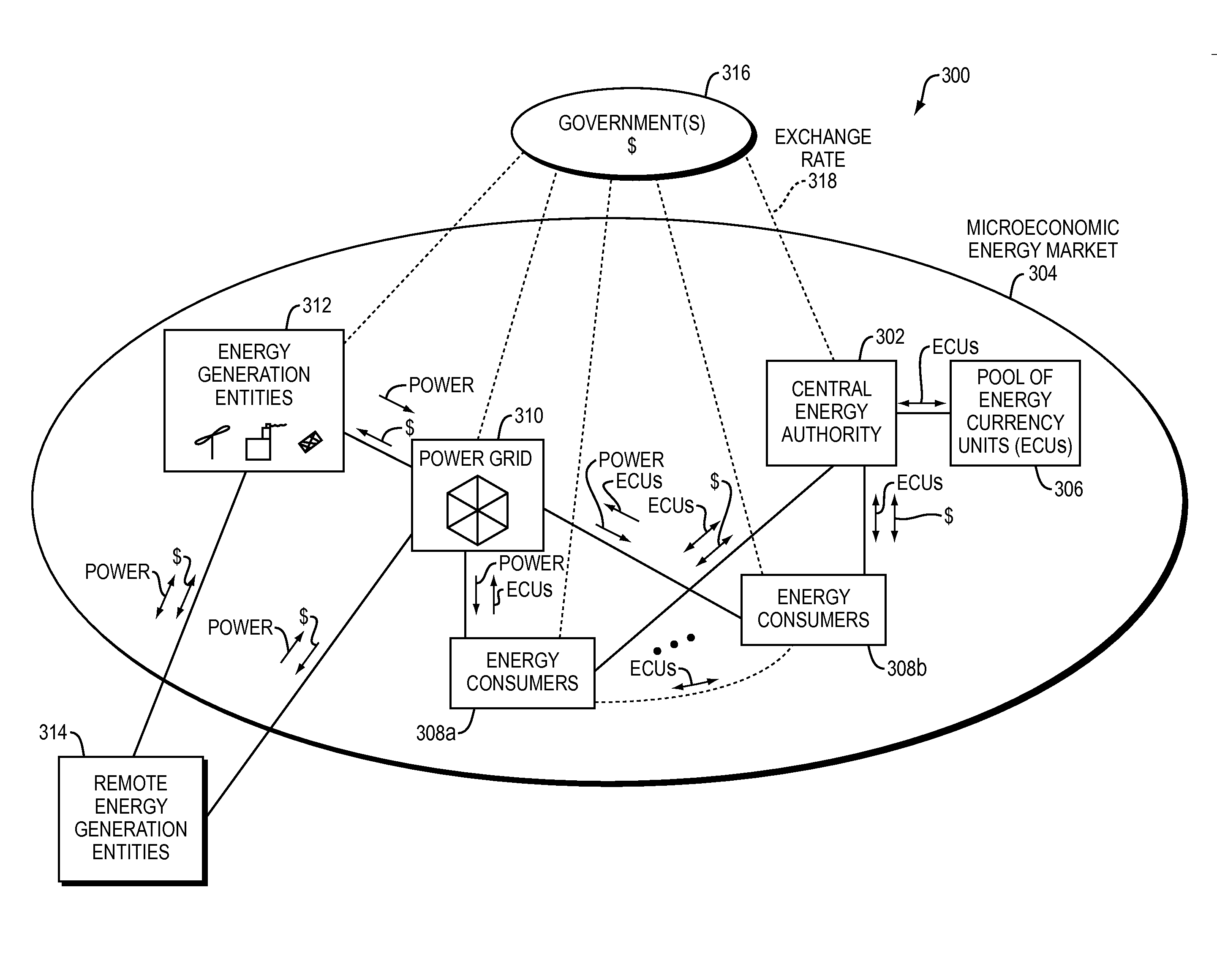

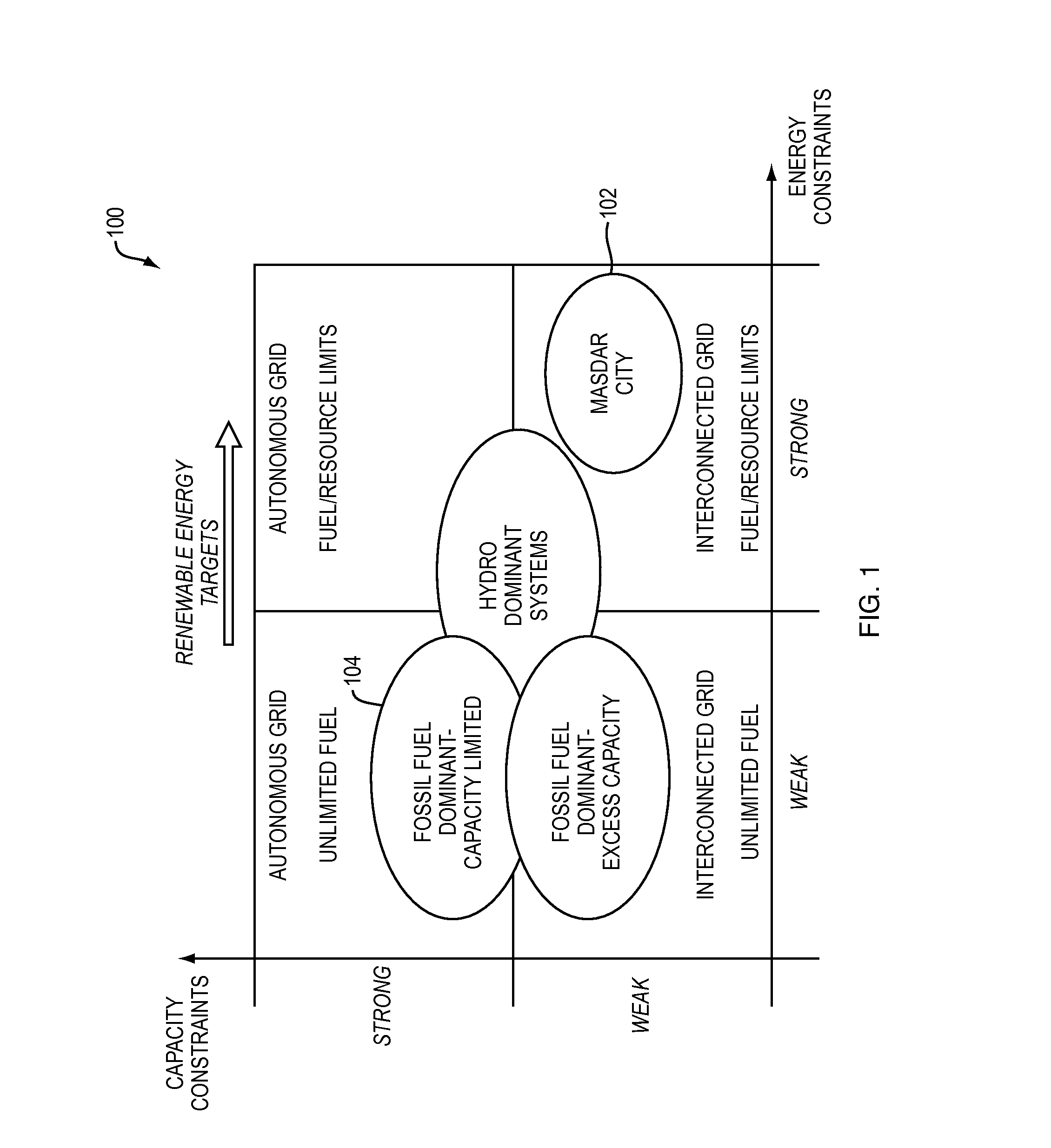

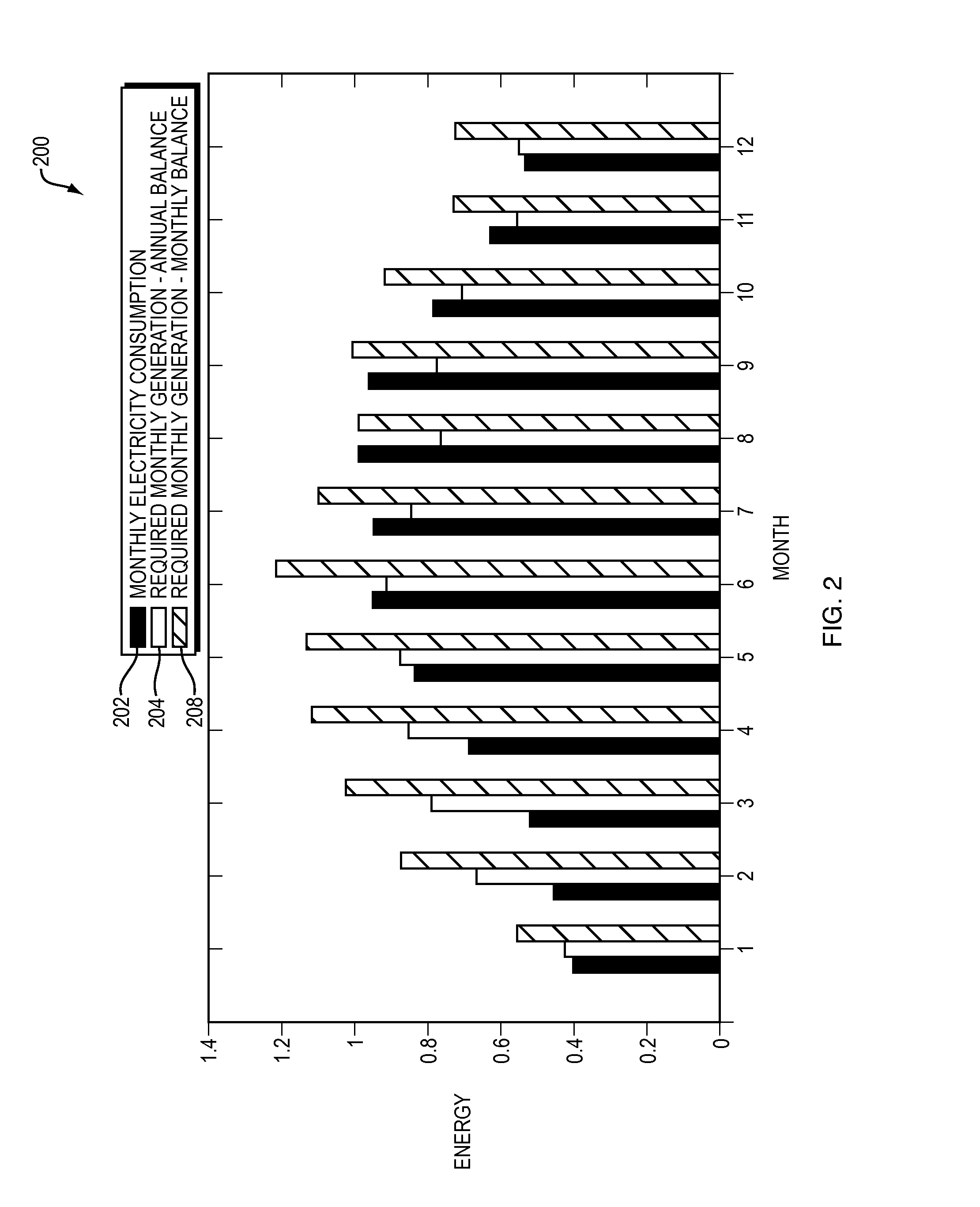

Hybrid Energy Market and Currency System for Total Energy Management

InactiveUS20130332327A1Simple and flexiblePermit auditingFinanceContinuous feedbackProcess engineering

A hybrid energy market and currency systems is provided to manage energy consumption in an energy market comprising a community of users. Energy currency units may be issued to users and an exchange rate between the energy currency units and a monetary currency unit may be set, providing a variable price for energy. Energy currency units may have a defined validity period, at the end of which the energy currency unit is automatically converted to monetary currency units. Users consume energy currency units through use of energy consumptive services, such as domestic consumption of electricity and hot water, and through use of transportation. Prices for energy may be set by comparing the cumulative actual and desired demand. By providing a continuous feedback mechanism, some embodiments of methods disclosed herein may raise an energy conscience—an awareness of when the community needs the help of its citizens to meet its ambitious sustainability goals.

Owner:MASDAR INST OF SCI & TECH

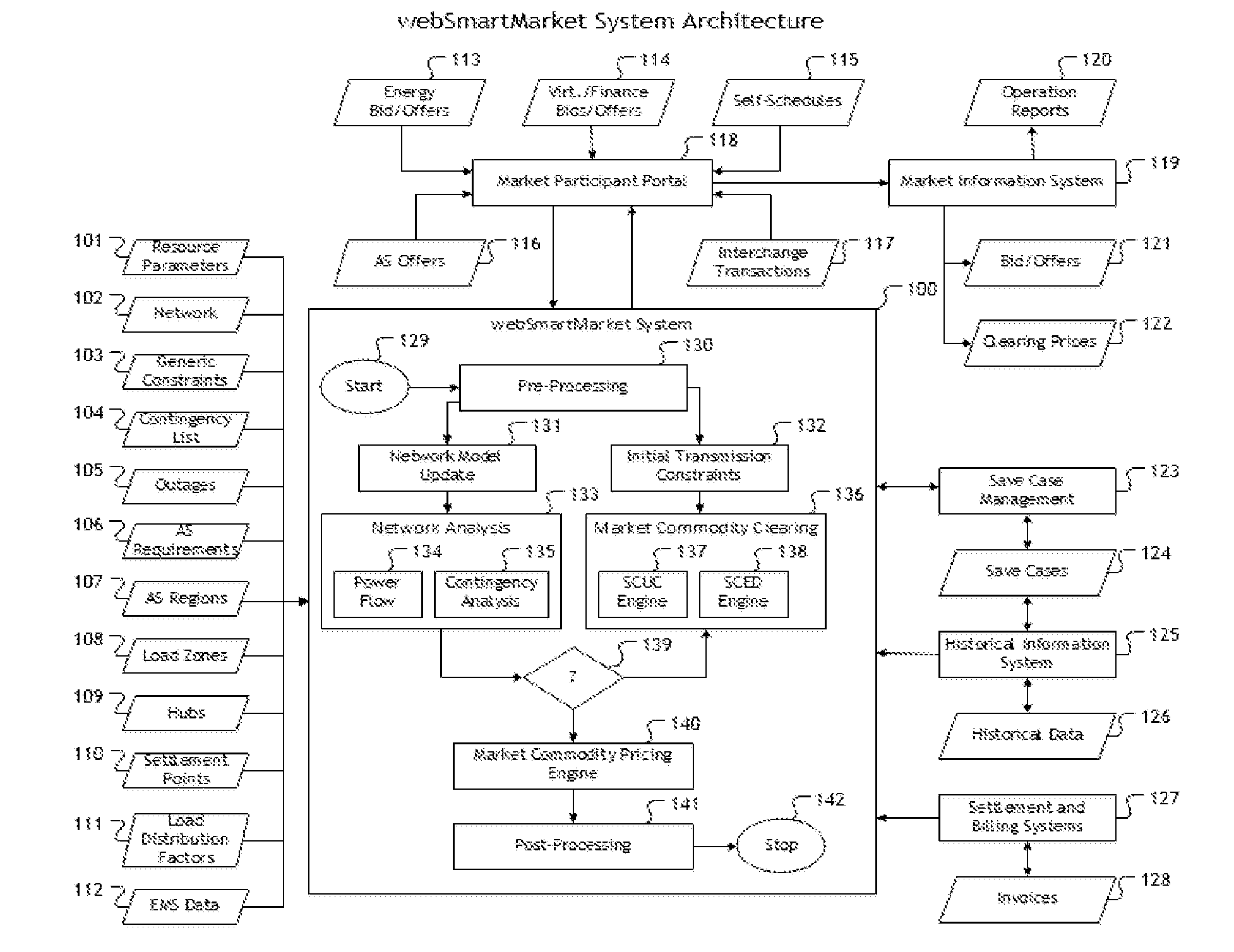

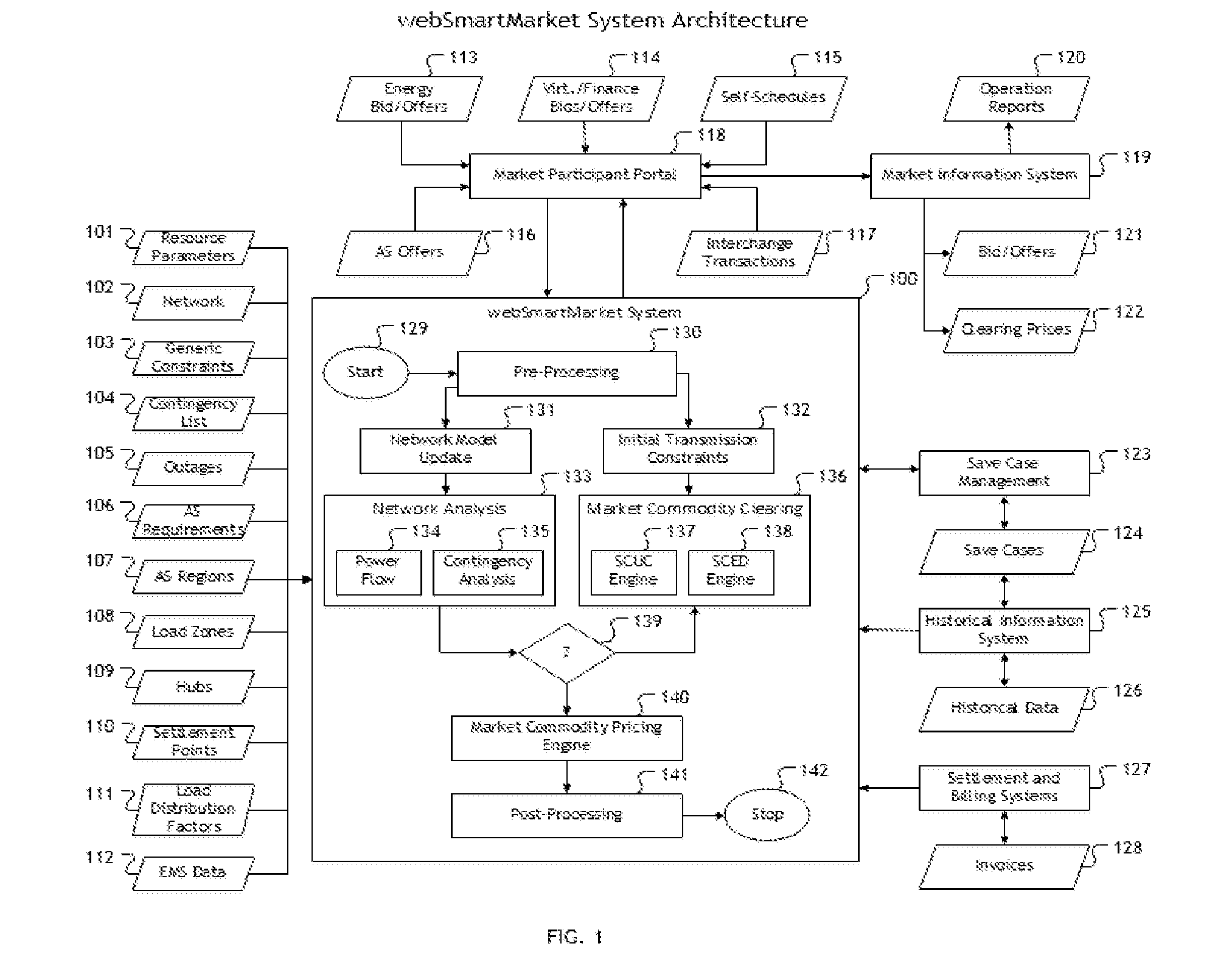

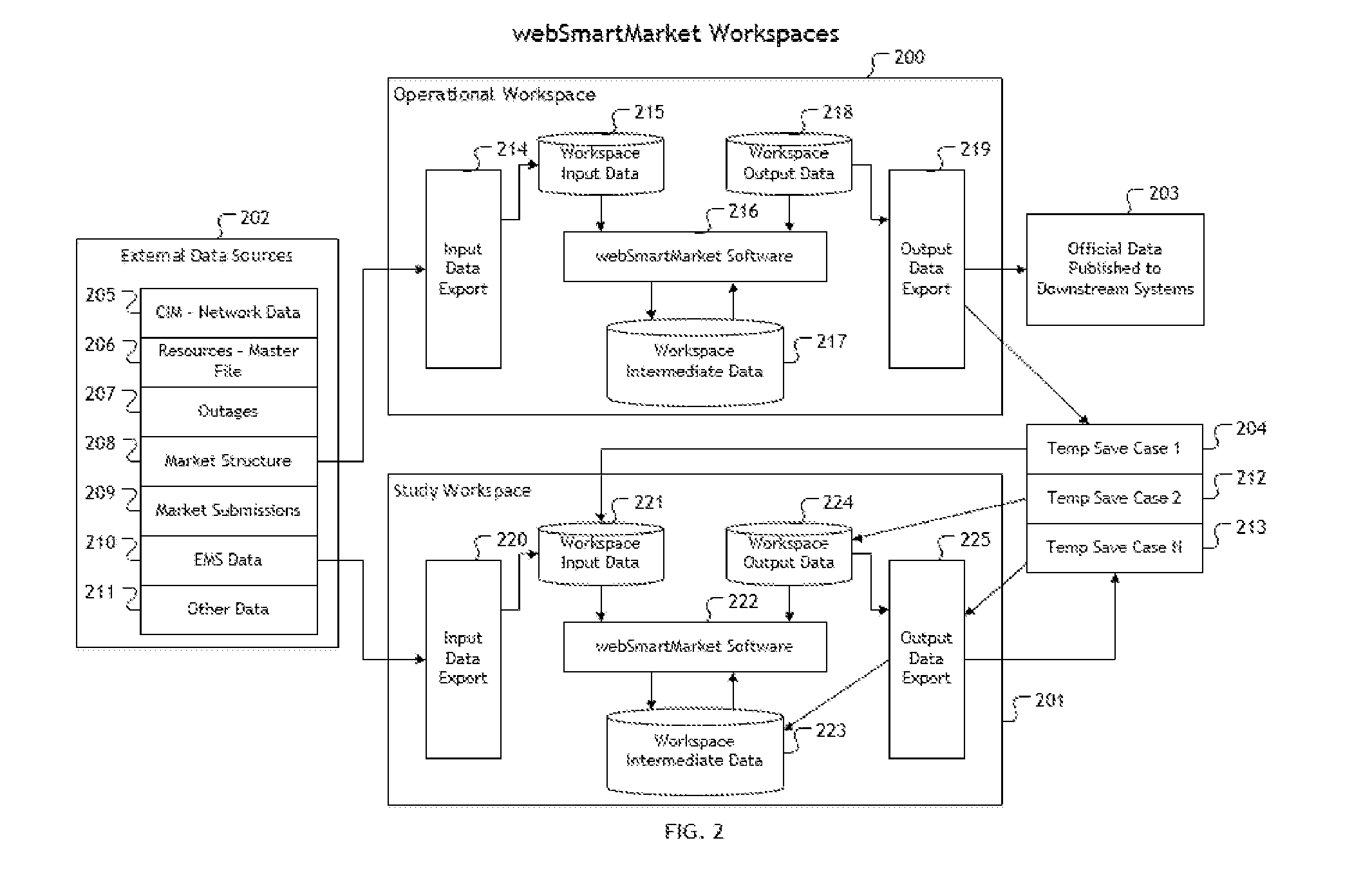

Next-Generation Energy Market Design and Implementation

ActiveUS20160098794A1Reduce restrictionsMaximizing economic efficiencyFinanceElectricity marketEngineering

A process / method is provided for the next generation of electricity market systems that support competitive trading of electric energy and ancillary services within day-ahead and real-time market operation frameworks. The invention comprises the systems and methods related to advances in electricity market architecture, functionality, and performance. The systems and methods of the invention ensure system operation reliability and maximize market economic efficiency of energy and ancillary services trading in competitive market environment.A process / method comprising optimal clearing and competitive price formation for a variety of market commodities that are supplied and consumed by a numerous market entities of a variety of types. The solution process is arranged and facilitated in controllable and efficient manner.

Owner:OPEN ACCESS TECH INT

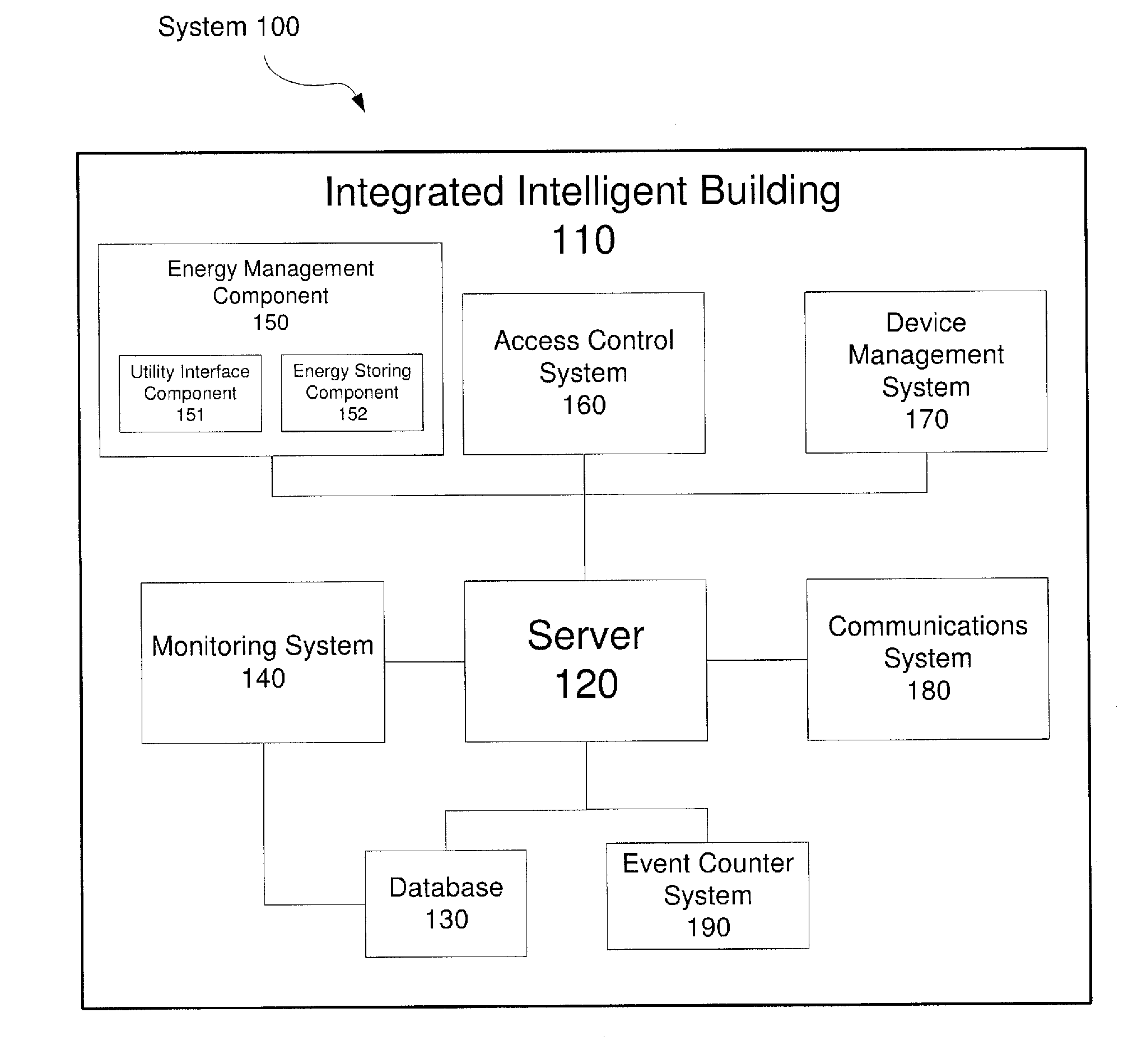

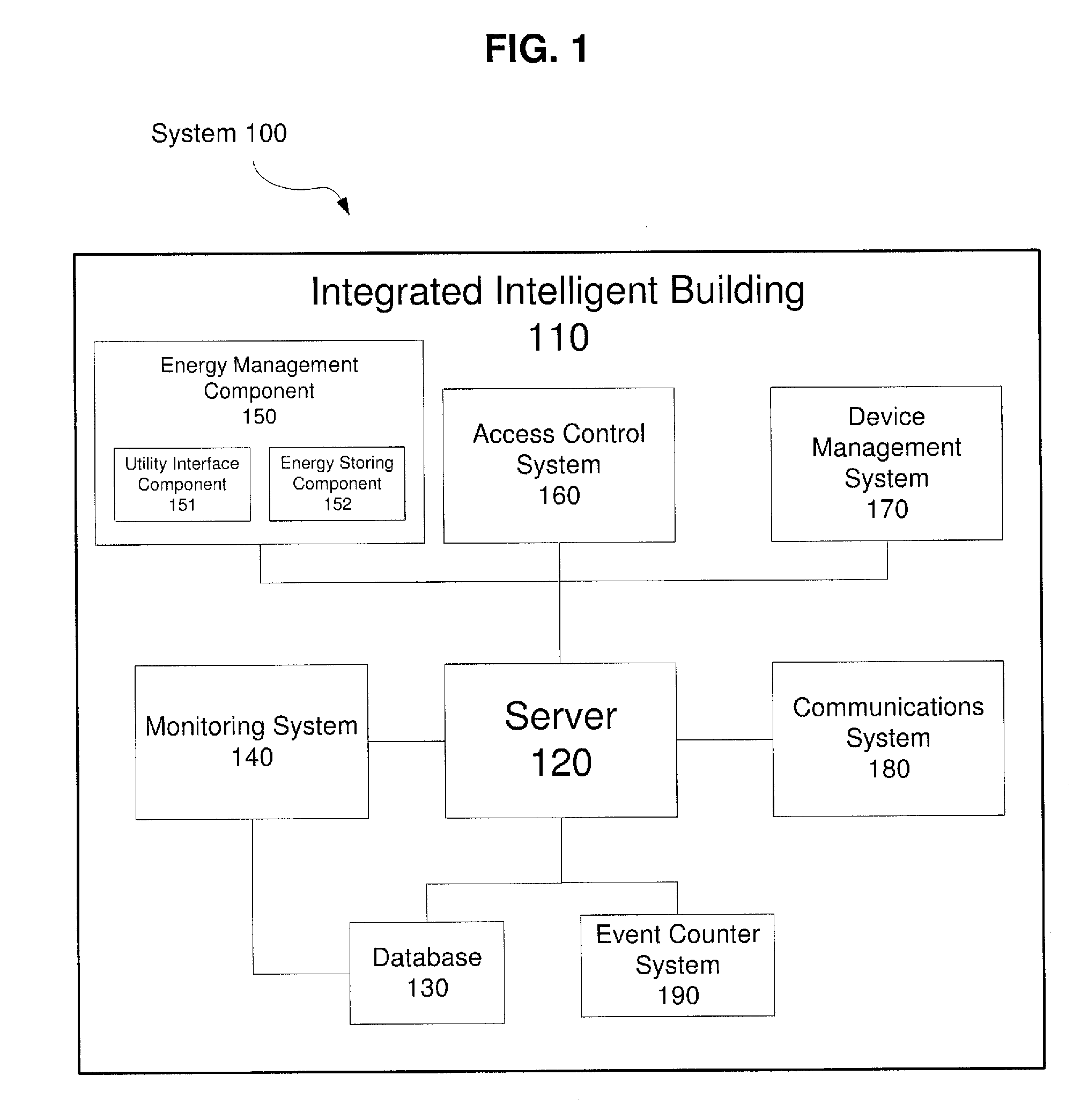

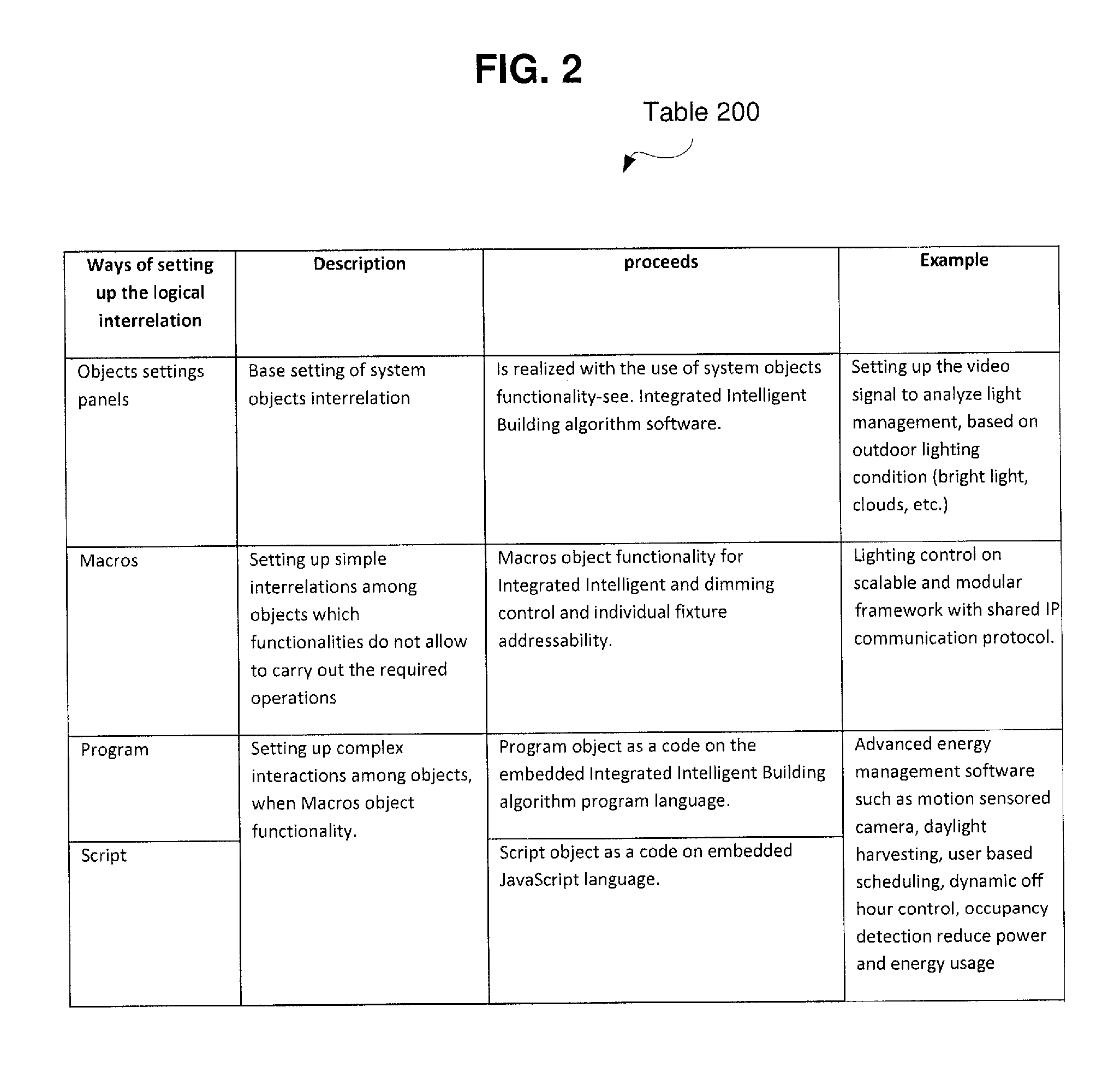

Method and System for an Integrated Intelligent Building

InactiveUS20110190952A1Improve building safetyMechanical power/torque controlLevel controlEnergy rateProcess engineering

Described herein are systems and methods for integrated intelligent buildings, improved building security, and cost-efficient energy management. An exemplary embodiment relates to a method comprising monitoring energy usage within a facility to generate energy usage data (“EUD”), analyzing the EUD to determine a short-term energy requirement (“STER”) and a long-term energy requirement (“LTER”) of the facility, obtaining energy market data (“EMD”) of energy, the EMD including energy rate fluctuation data, and obtaining a pre-determined amount of energy from a utility provider, the pre-determined amount being determined as a function of at least one of the STER, the LTER, and the EMD.

Owner:VISISYS HLDG

Facilitating revenue generation from data shifting by data centers

ActiveUS9159042B2Low costIncrease incomeProgramme controlTechnology managementTime scheduleEnergy management system

Owner:VIRIDITY ENERGY SOLUTIONS INC

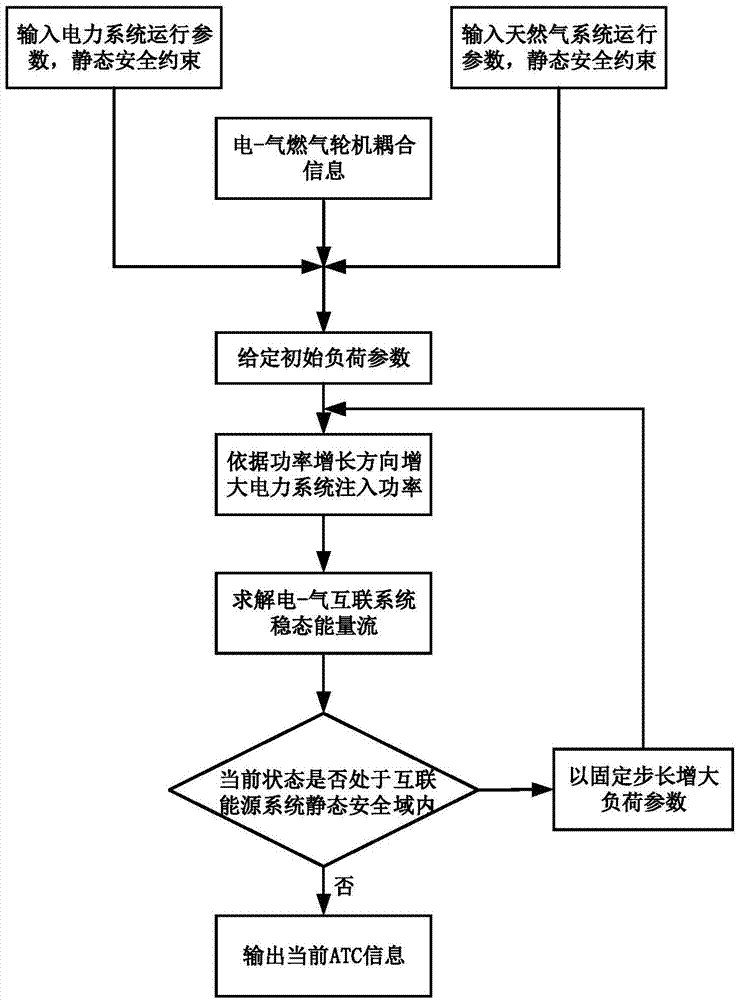

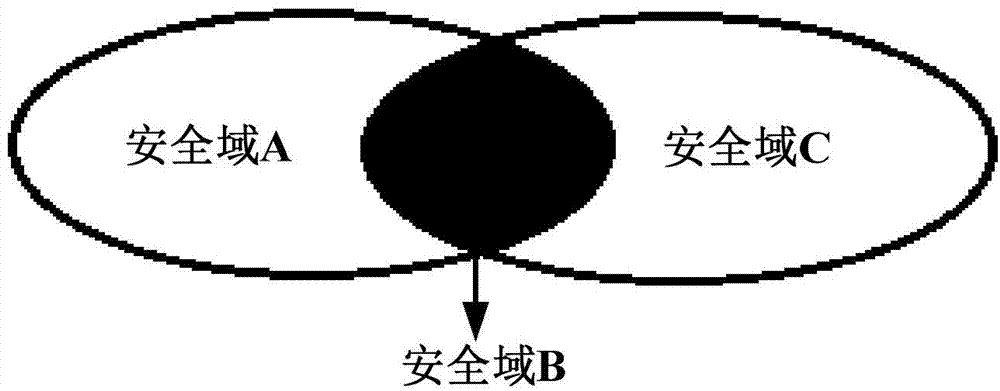

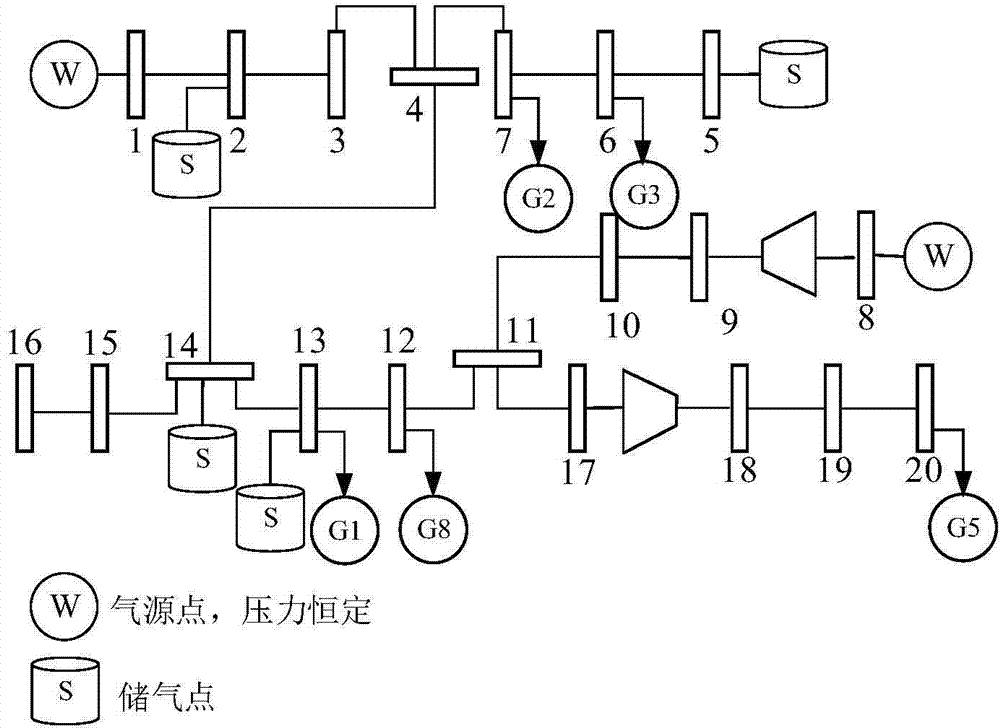

Method of acquiring available transfer capacity of electricity-gas interconnected energy system

ActiveCN104734155AEnsure safetyGuaranteed reliabilityLoad forecast in ac networkSingle network parallel feeding arrangementsEngineeringGas transfer

The invention discloses a method of acquiring available transfer capacity of an electricity-gas interconnected energy system and provides a concept of a static safety domain of the electricity-gas interconnected energy system. By means of solution by the continuous power flow method, solved is the problem that the traditional method of acquiring available transfer capacity, making no consideration on primary energy supply of NGFPP (natural-gas fired power plants) and operation constraints of a natural gas system, may drive the operation state of the natural gas system to exceed the safety constraint, thus influencing primary energy supply of the NGFPP. Verification by the interconnected energy system composed of an IEEE 39-node power transfer system and a 20-node Belgium gas transfer system shows that the method is generally applicable, ensuring safety and reliability of primary energy supply of the NGFPP; meanwhile, ATCs (available transfer capacities) of different areas are analyzed with a uniform energy market, and greater economic benefit is brought to participants of the whole energy market at the premise of ensuring the safety of the interconnected energy system.

Owner:HOHAI UNIV

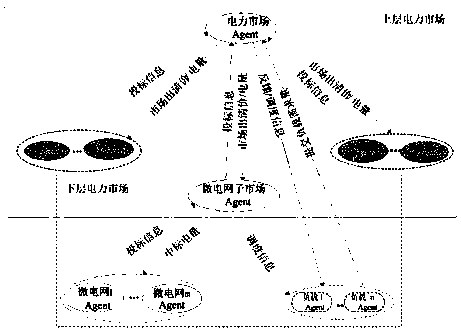

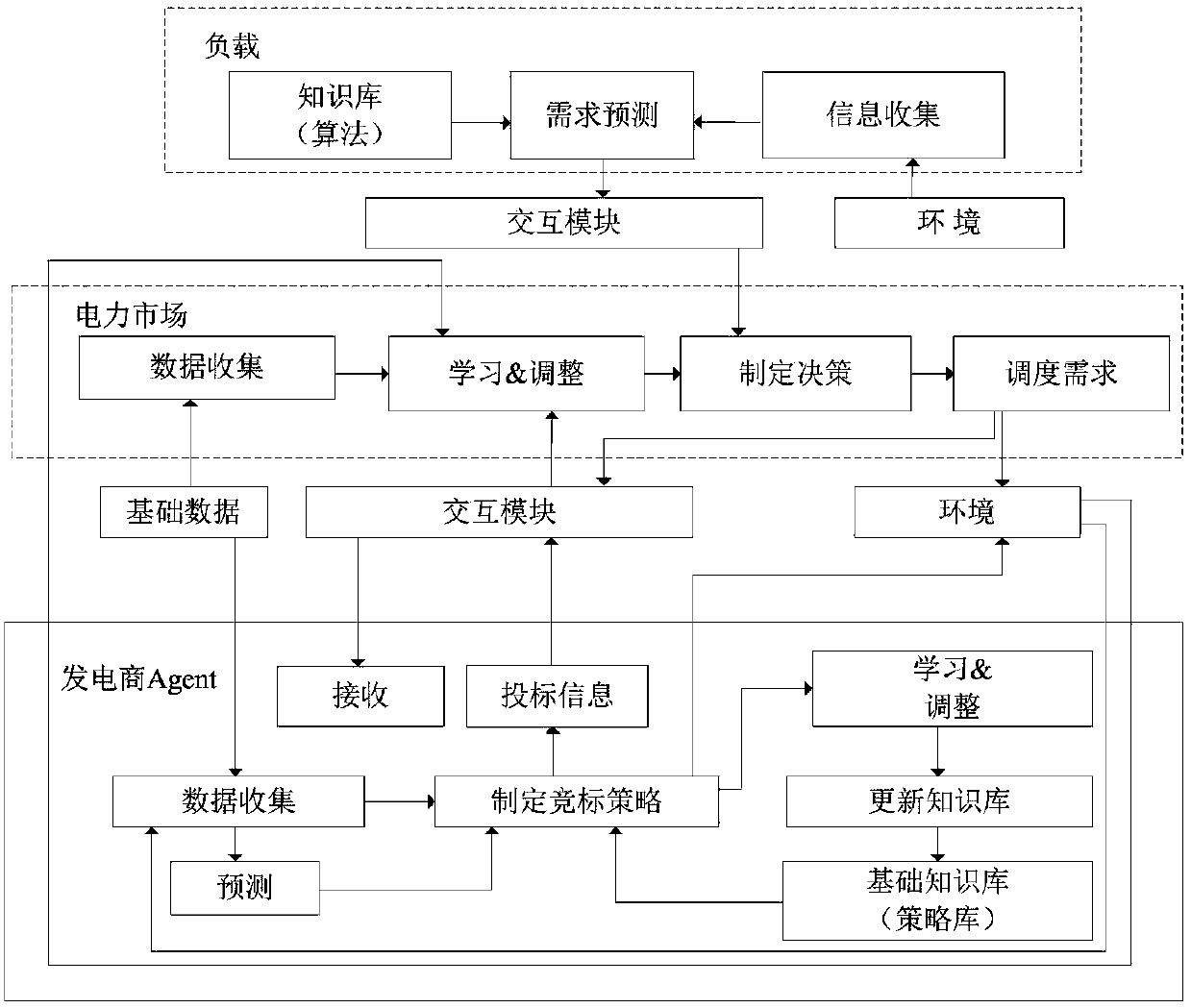

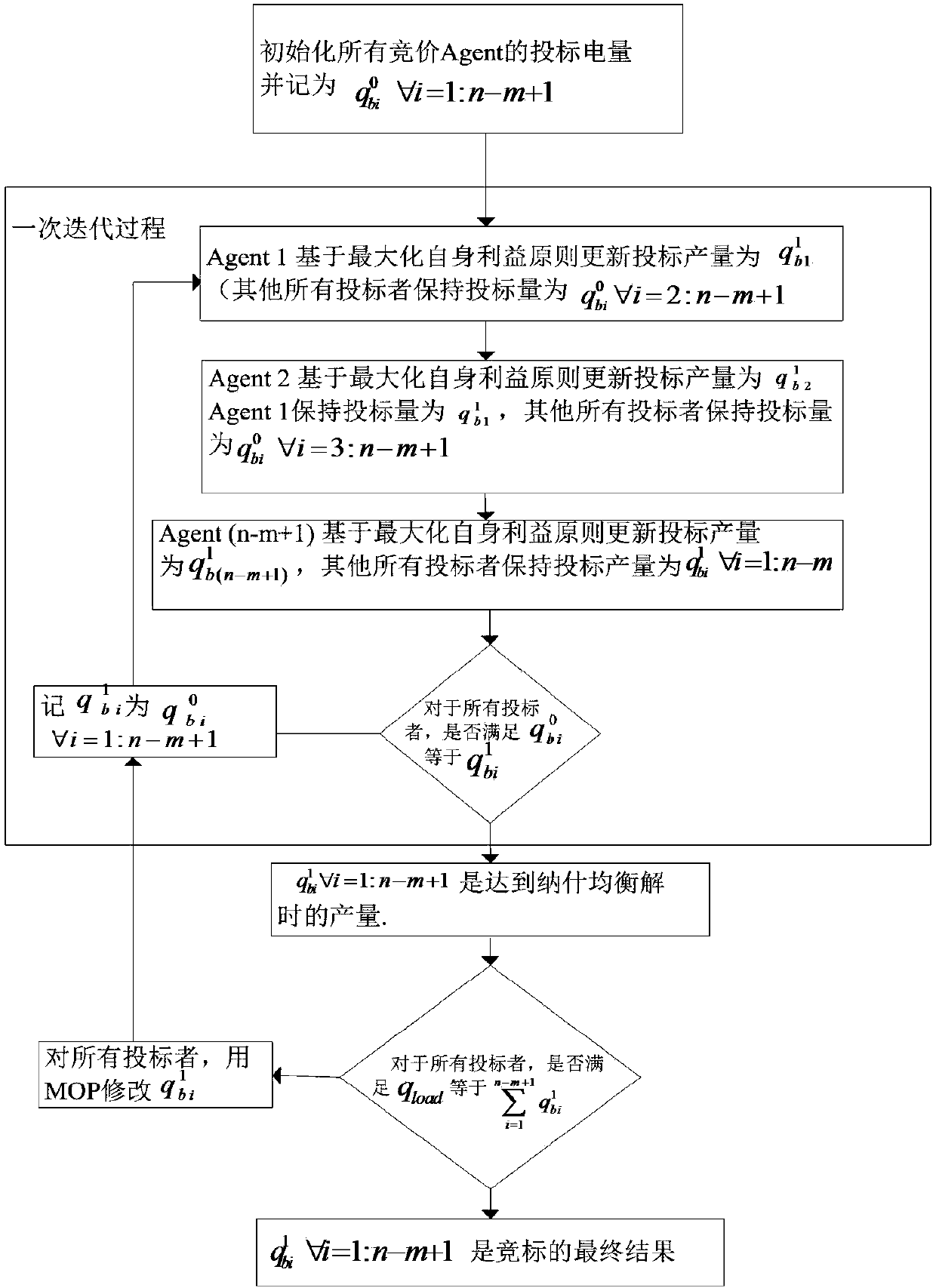

Microgrid electric power market dual-layer bidding method based on multi-agent system and game method

InactiveCN107067281ARaise the ratioGuarantee market operationMarket predictionsMicrogridElectricity market

A microgrid electric power market dual-layer bidding method based on a multi-agent system and the game method comprises: constructing a dual-layer bidding system based on multi-agent system, dividing an actual electricity market into two electricity submarkets, and in the upper layer of the electricity market, allowing a microgrid to participate in market bidding with traditional generation companies in an alliance mode; in the lower layer of the electricity market, taking the market shares obtained by the microgrid alliance in the competition of the upper layer of the electricity market as a market requirement amount, performing market competition between the microgrids again, and finally taking the obtained market shares as the final electric quantity obtained by the microgrids in the whole electricity market competition; constructing an electricity market dual-layer bidding model based on the game method; performing solution of the upper layer of the electricity market; performing solution of the lower layer of the electricity market; and verifying the utility validity of the dual-layer bidding system based on the multi-agent system through a simulation experiment. The microgrid electric power market dual-layer bidding method based on the multi-agent system and the game method improve the proportion of renewable and clean energy resource provided by the microgrid in the energy market.

Owner:YANSHAN UNIV

Systems and methods of determining optimal scheduling and dispatch of power resources

ActiveUS9865024B2Reduce operating costsMarketingInformation technology support systemData acquisitionMarket based

Owner:OPEN ACCESS TECH INT

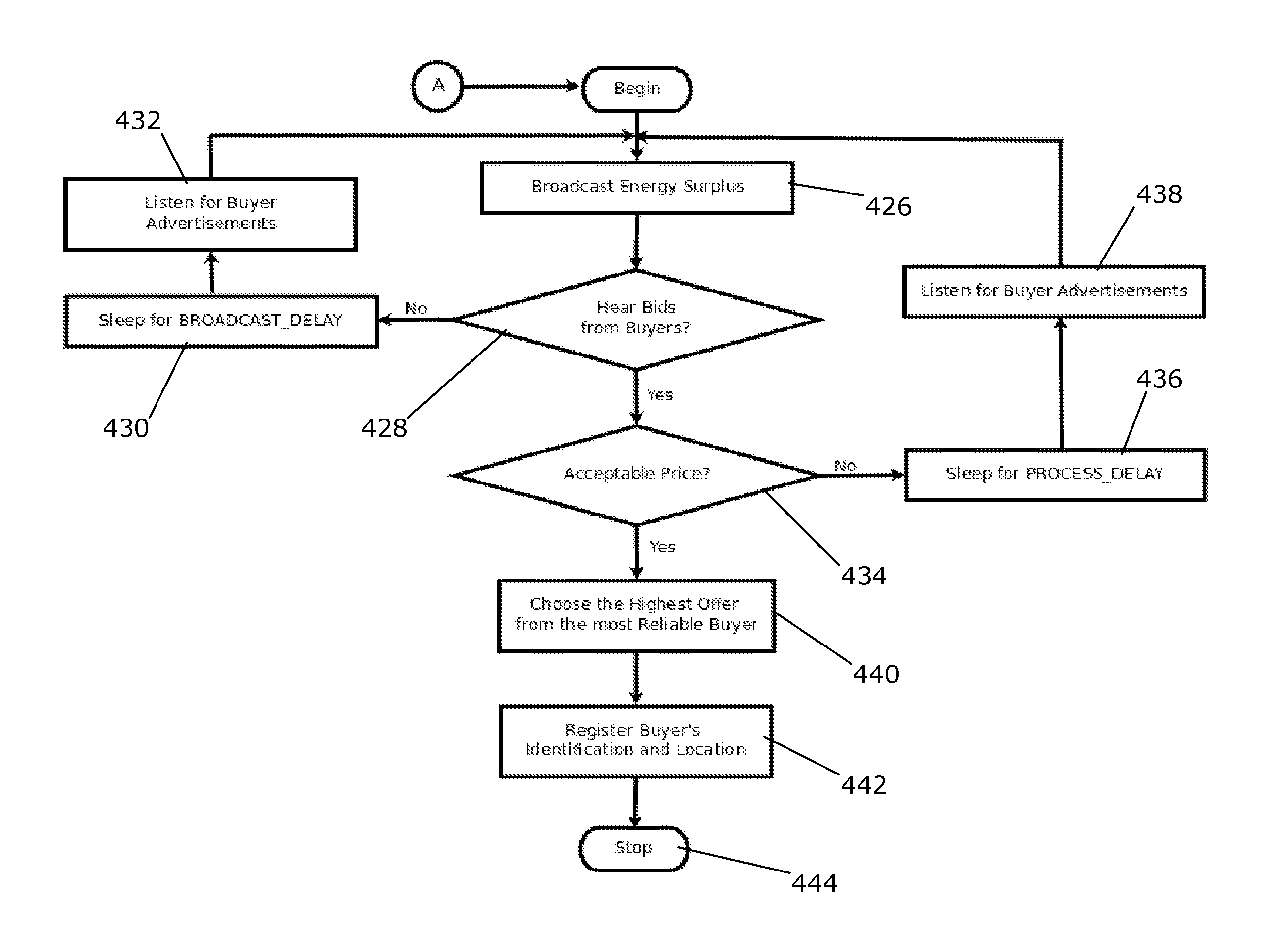

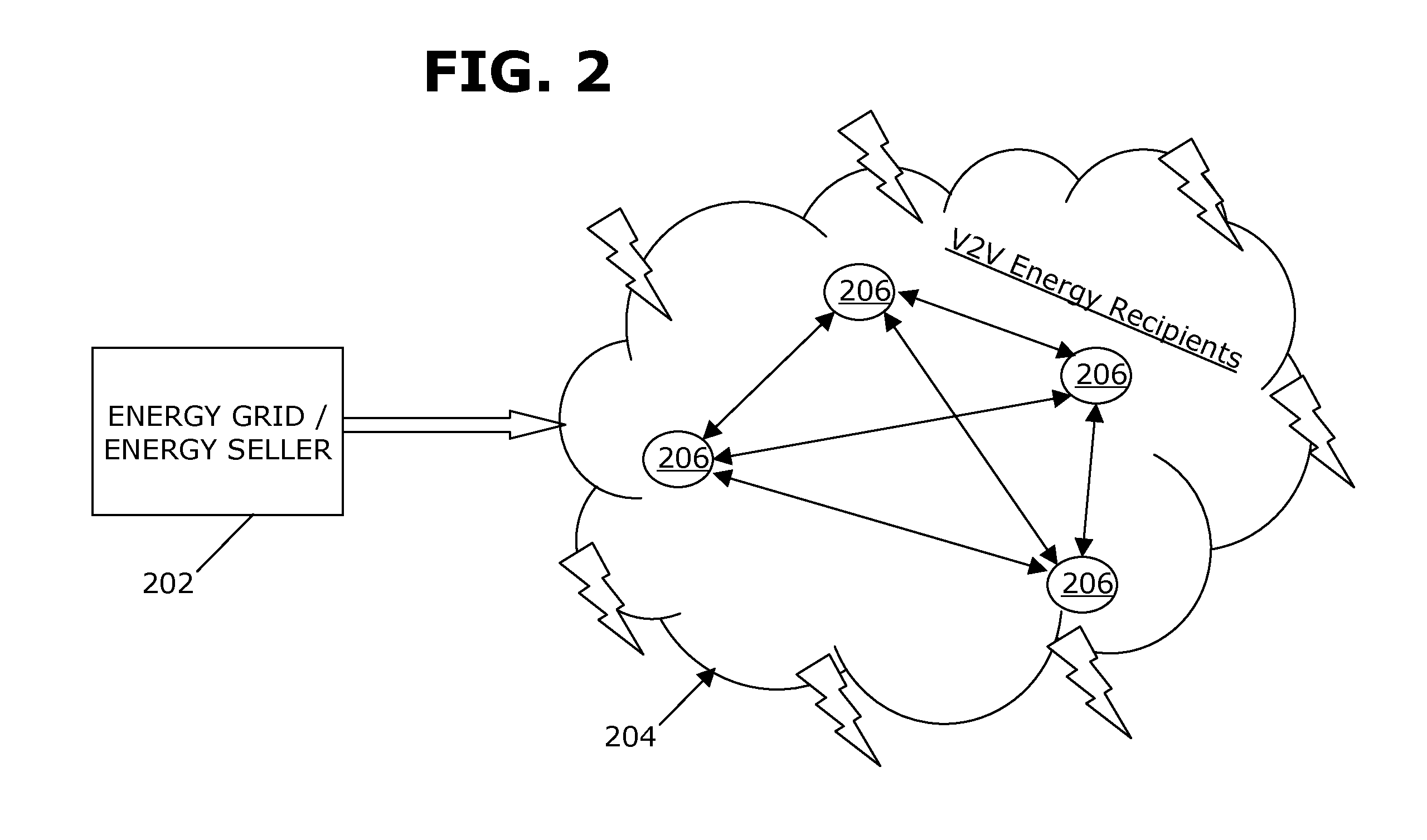

Vehicle-to-vehicle energy market system

Owner:IBM CORP

Electric-thermal coupling multi-energy flow network node energy price calculation method

InactiveCN106339794ABreak the status quo that joint cost pricing can only decouple computingHigh precisionResourcesSystems intergating technologiesElectricity priceSimulation

The invention relates to an electric-thermal coupling multi-energy flow network node energy price calculation method, and belongs to the field of the energy market of a comprehensive energy system. According to the method, the coupling relationship of electricity price and heat price in an electric-thermal coupling network is considered, the present situation that joint cost pricing of a thermal-electric joint supply set can only be calculated in a decoupling way can be broken through, and the market interaction mechanism of the electric-thermal coupling system is restored so that the accuracy of marginal cost calculation can be enhanced in comparison with the existing method of respective pricing of the power supply and heat supply systems. Meanwhile, node energy price acts as one of real-time price and compensates the blank of real-time heat price in the heat supply network so that a certain thought is provided for congestion management and network loss allocation of the heat supply network.

Owner:TSINGHUA UNIV

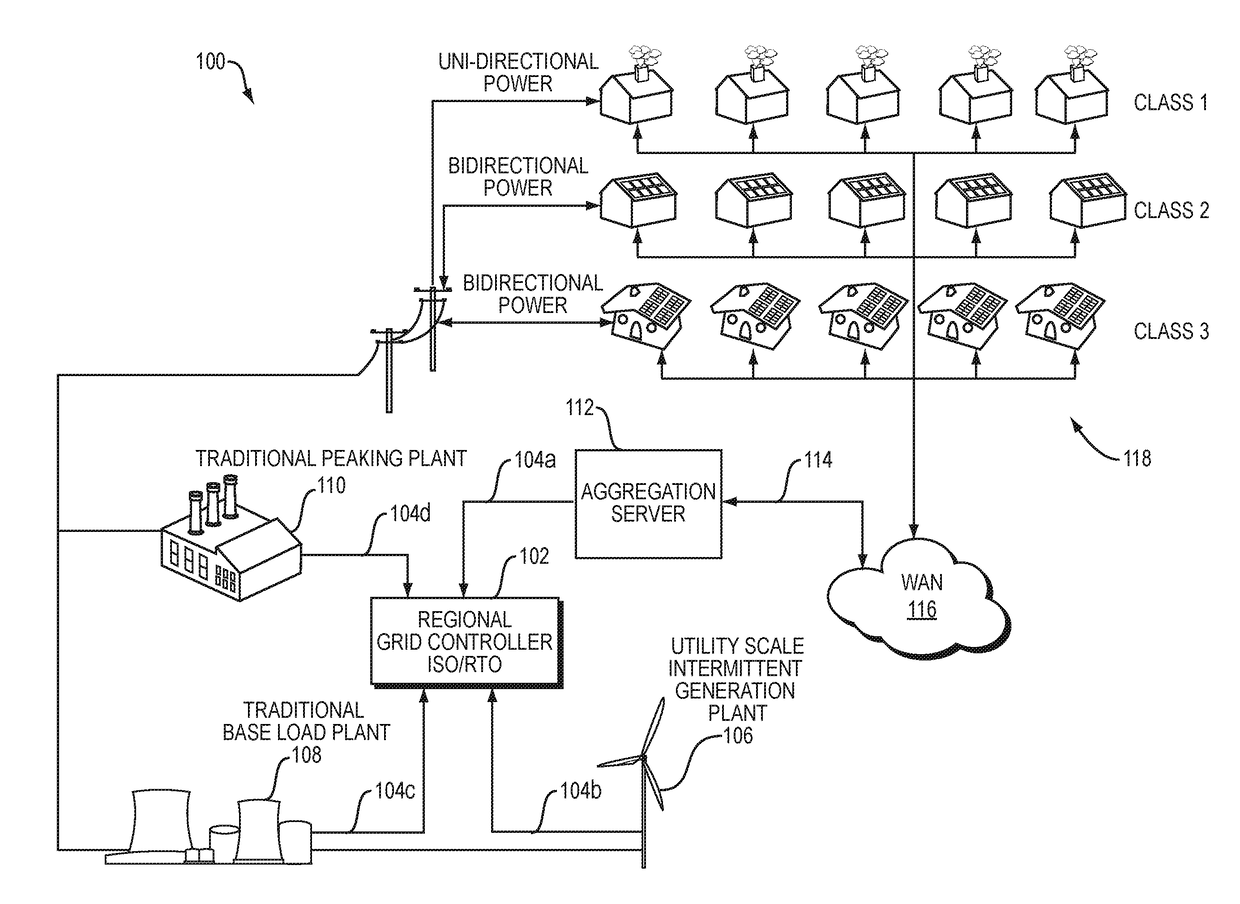

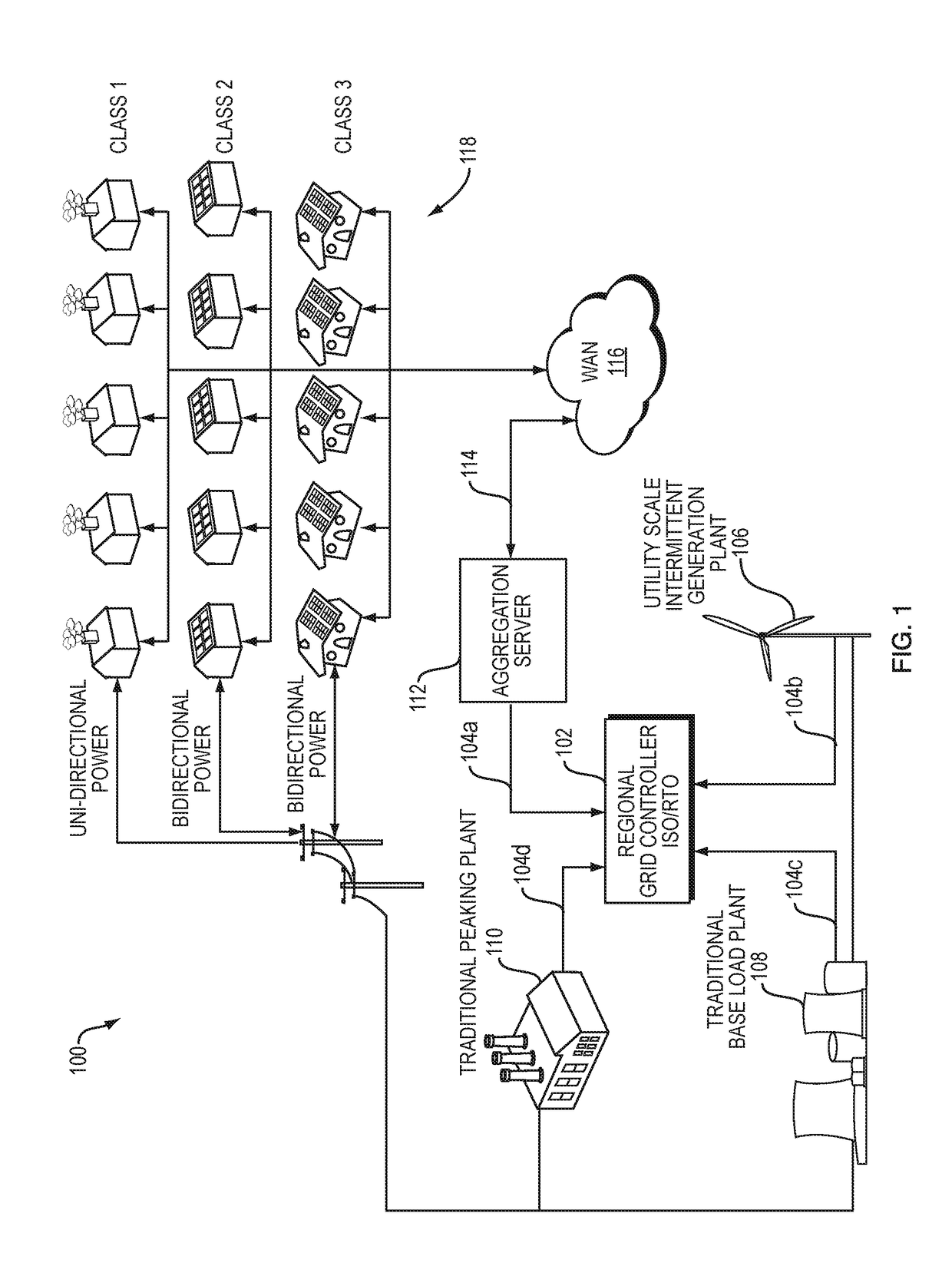

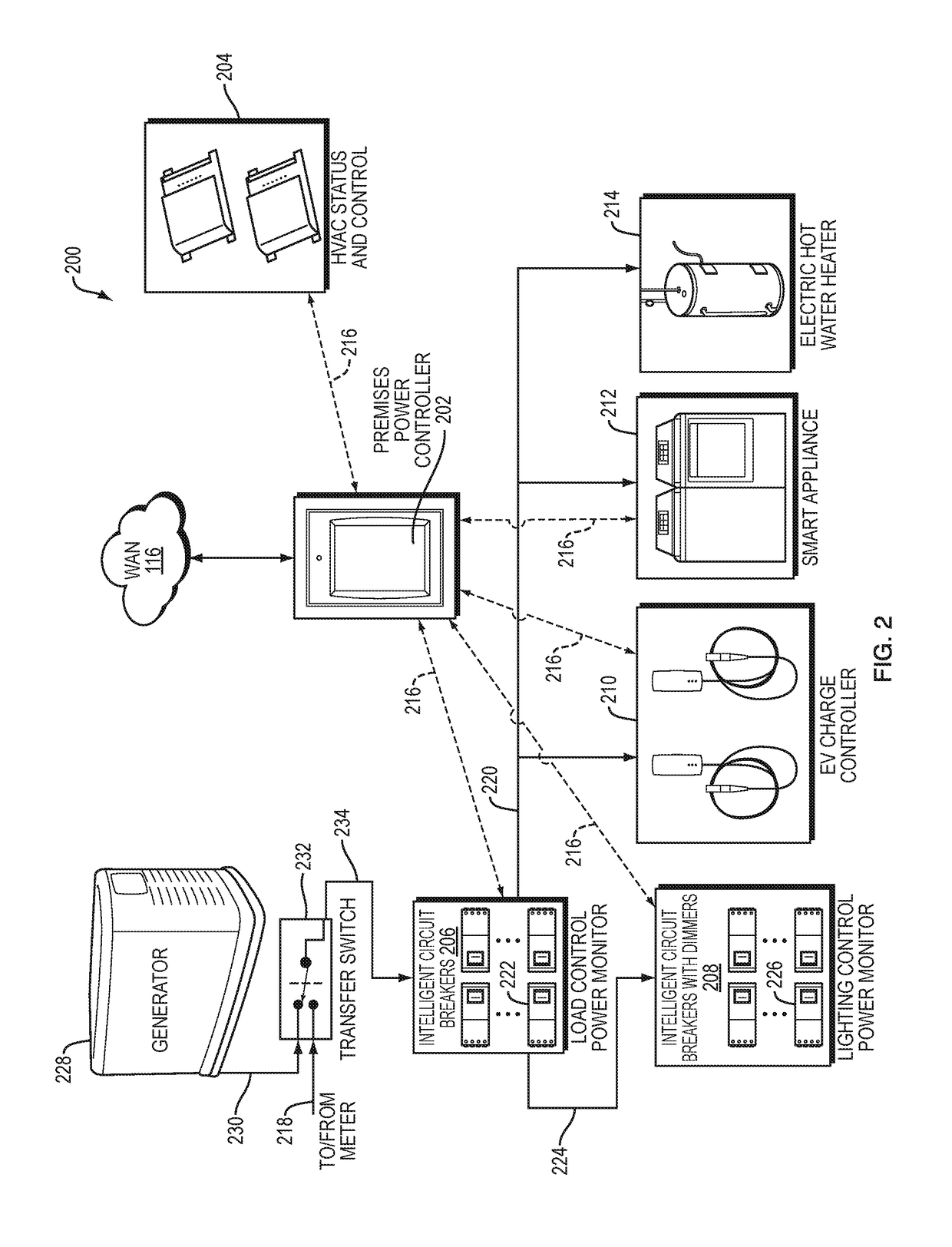

System and methods for creating dynamic NANO grids and for aggregating electric power consumers to participate in energy markets

ActiveUS20180075548A1Reduce loadReduce power consumptionPower network operation systems integrationElectric ignition installationPower controllerPeaking power plant

A group of homes, businesses, or other electric power consuming premises are aggregated and commonly controlled to dynamically reduce loads in sufficient quantities, and with sufficient rapidity and duration, to participate as a market participant in the energy markets including participating as a peaking power plant. While the amount of reduced power consumption for a single premises is typically quite small, the total reduced consumption of an aggregation of just a few thousand homes or businesses may be on the order of hundreds of kilowatts. A premises power controller in conjunction with intelligent circuit breakers, which may include dimmers, enable dynamic management of individual loads in each premises.

Owner:SAVANT SYST INC

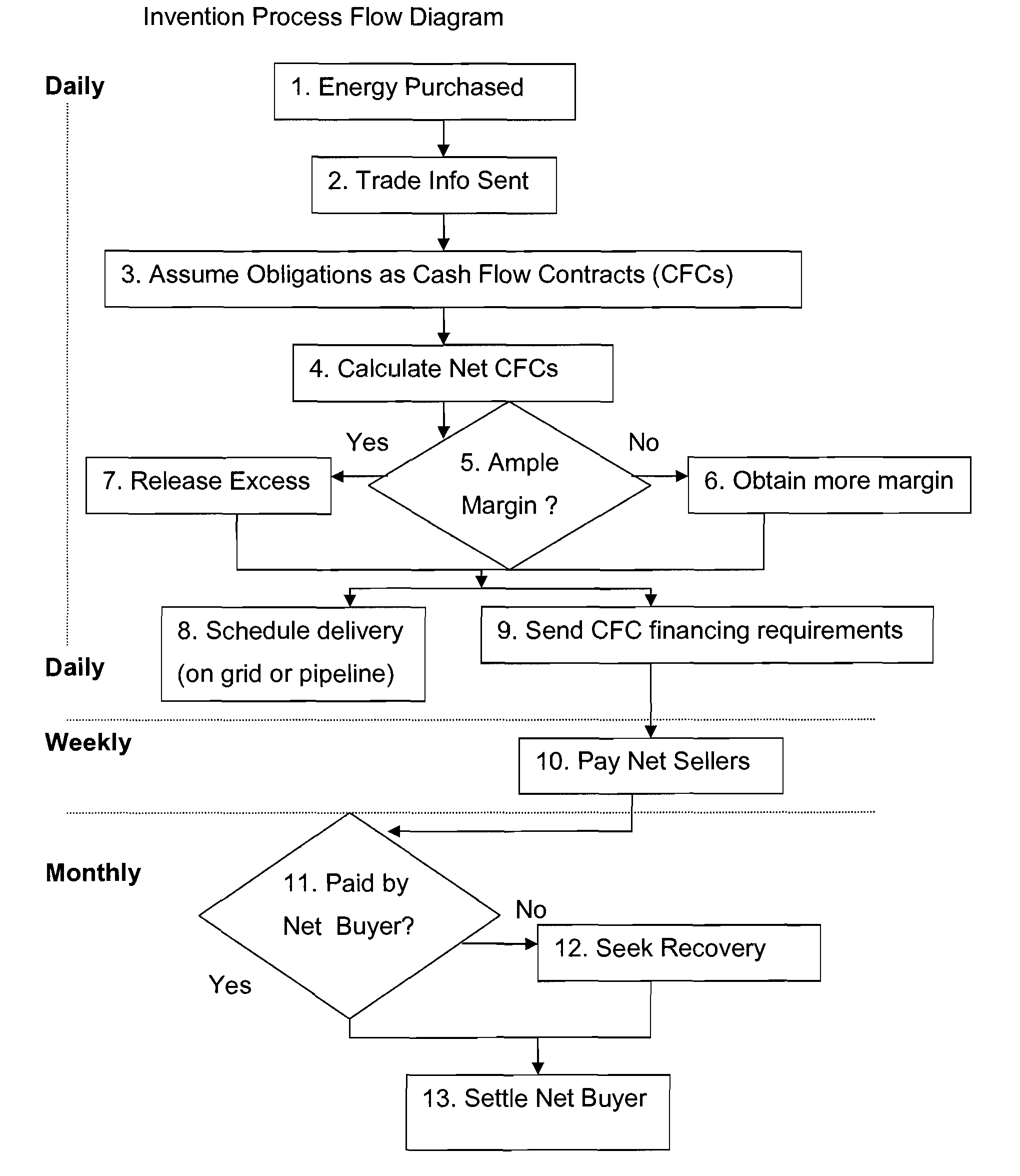

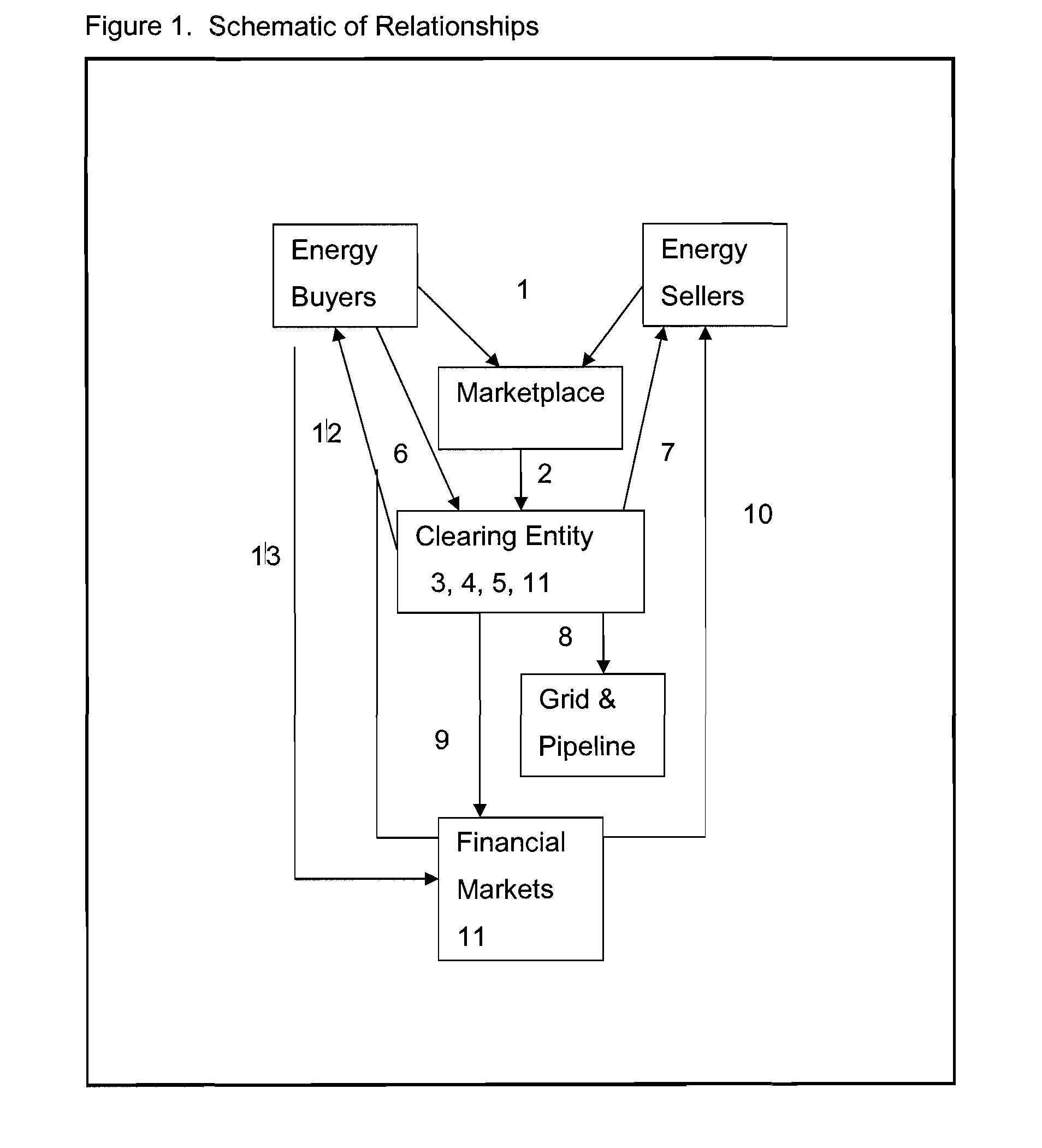

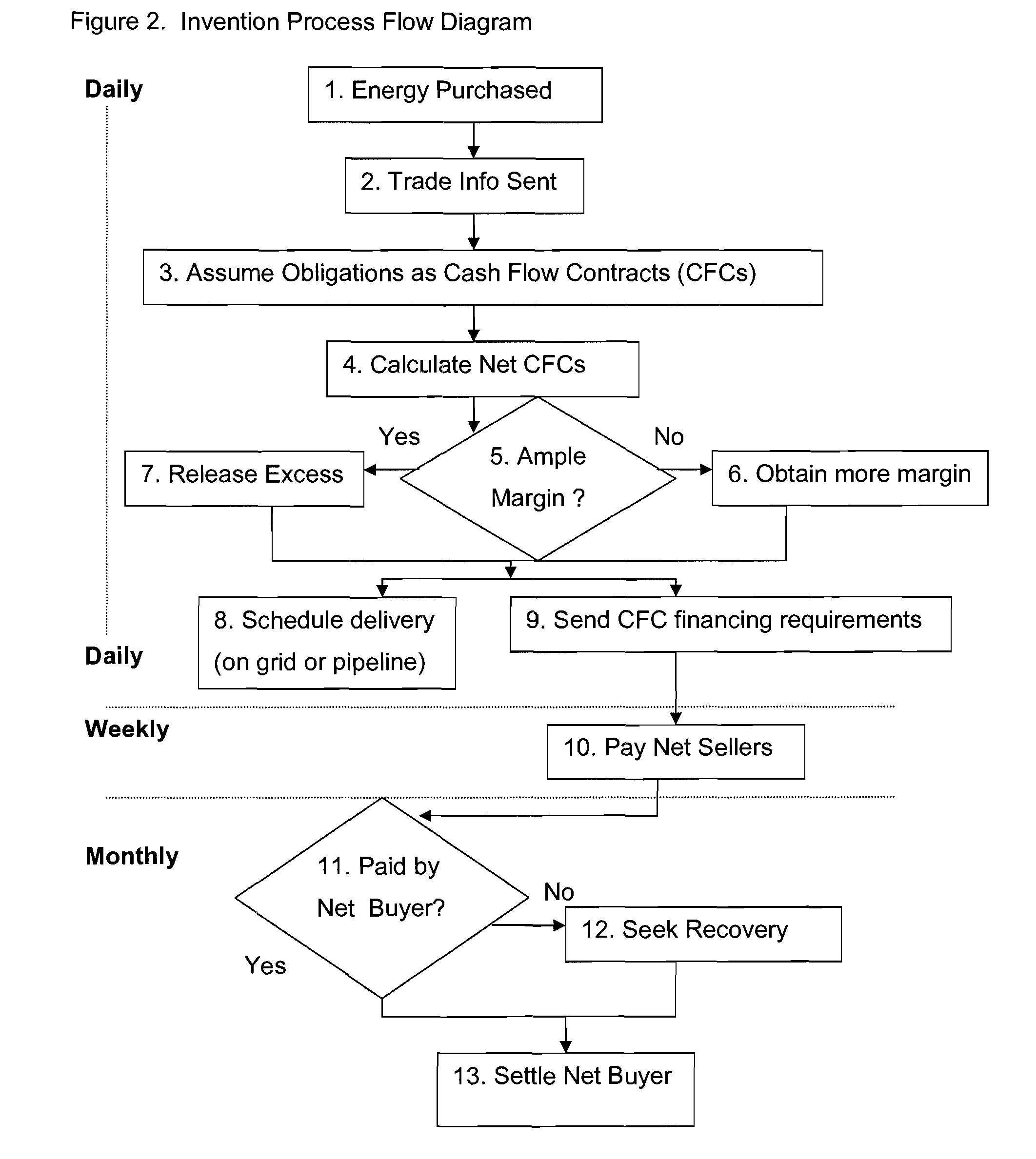

Utilizing Cash Flow Contracts and Physical Collateral for Energy-Related Clearing and Credit Enhancement Platforms

In accordance with the present invention, a financial instrument for the energy market is created. The financial instrument comprises a derivative instrument related to accounts receivable or accounts payable or both. In a preferred embodiment, the derivative instrument normally consists of two sets of linked swaps. In the first set, the seller exchanges two things with a third party: (i) the right for payment of accounts receivable within a month from the buyer is exchanged for the right to payment of such accounts receivable within a week from the third party; and (ii) the obligation to deliver energy to the buyer is exchanged for the obligation to deliver to the third party. The buyer exchanges the mirror image of those with a third party, to with: (i) the obligation to pay within a month to the seller is exchanged for the obligation to pay within a week to the third party, but the buyer receives financing to offset the cash flow ramifications; and (ii) the obligation to take delivery from the seller is exchanged with the obligation to take delivery from the third party. The swap can further be utilized to net payment obligations under multiple cash and forward commodity transactions between the buyer and the seller. Physical collateral is utilized as margin. In accordance with another aspect of the present invention, the process takes place on a ‘clearing platform’ for such energy transactions.

Owner:NASDAQ INC

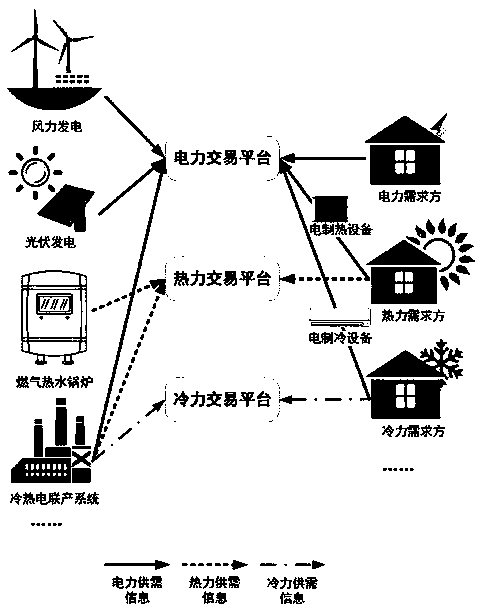

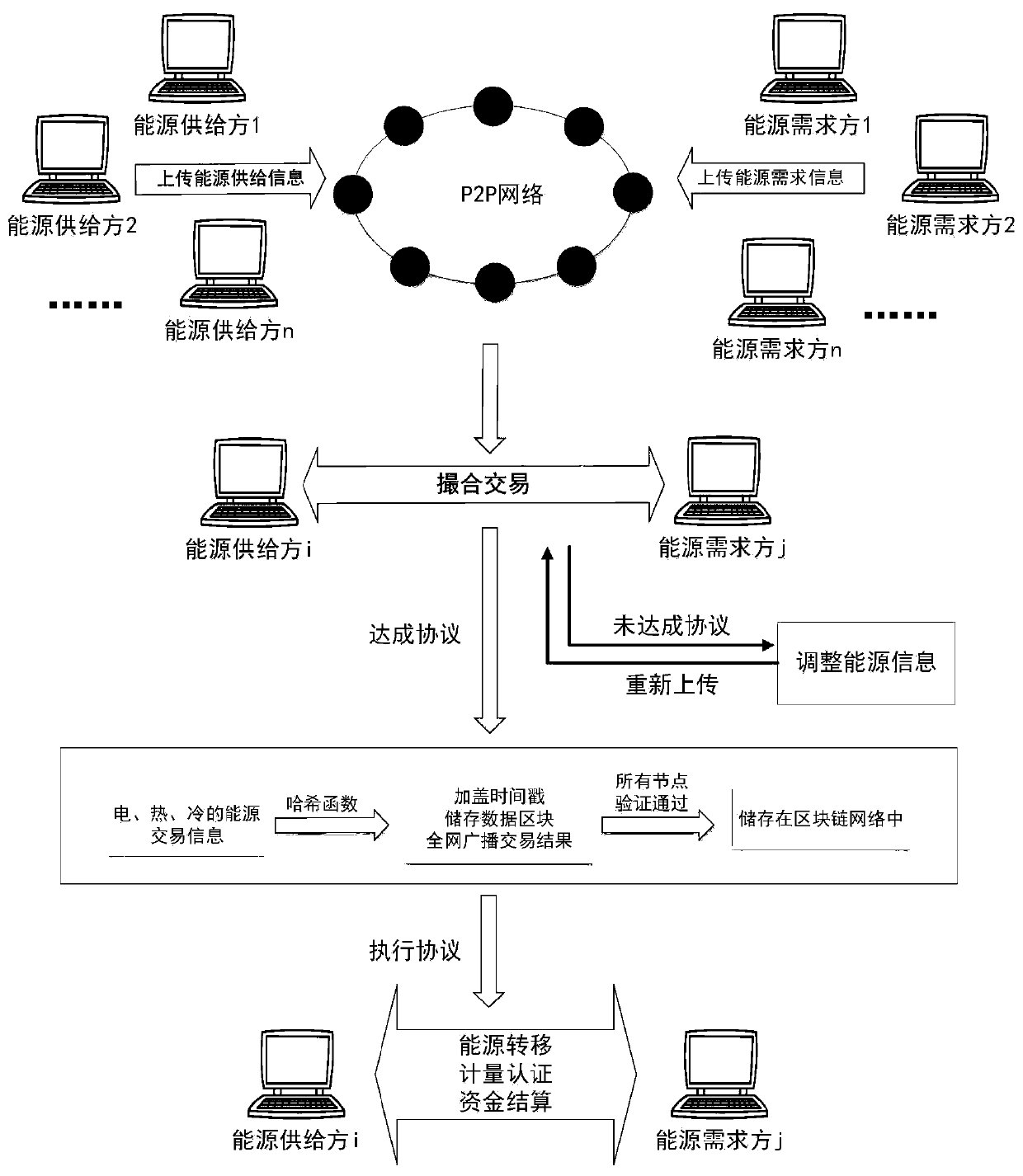

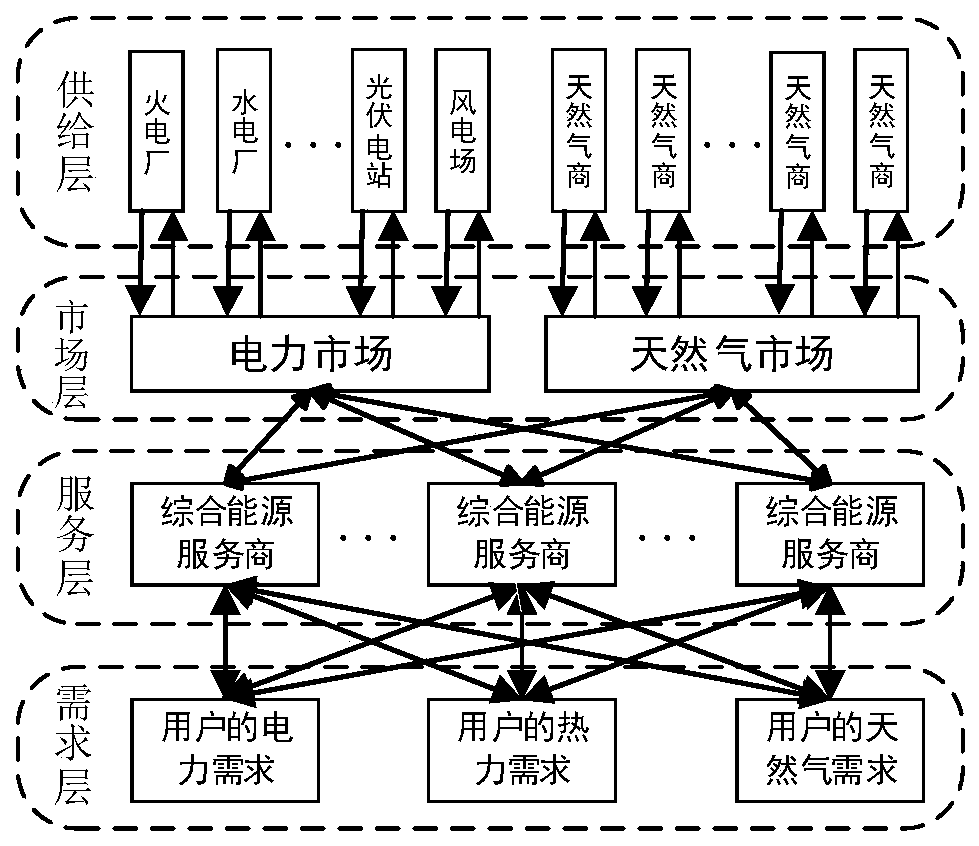

Comprehensive energy marketization transaction architecture and method based on block chain

InactiveCN111078791AOpen and transparentAchieve transferFinanceDatabase distribution/replicationIntegrated energy systemFinancial transaction

The invention discloses a comprehensive energy marketization transaction architecture and method based on a block chain. The blockchain technology is applied to the market transaction of each participant of the comprehensive energy. Based on the technical advantages of blockchain decentralization, openness, transparency, safety, credibility, information traceability, tamper resistance and the like, an equal credibility and information sharing marketization transaction architecture is established in the comprehensive energy system, and point-to-point energy transfer and transaction settlement of each participant are realized. According to the transaction architecture and method provided by the invention, an energy management mode from bottom to top can be formed in the comprehensive energysystem, and electricity, heat, cold and other energy supply and demand subjects can perform trusted transaction and scheduling without depending on a third party, thereby facilitating safe and stableoperation of the comprehensive energy system, improving the energy utilization efficiency and maximizing the benefits of each party.

Owner:NORTH CHINA ELECTRIC POWER UNIV (BAODING)

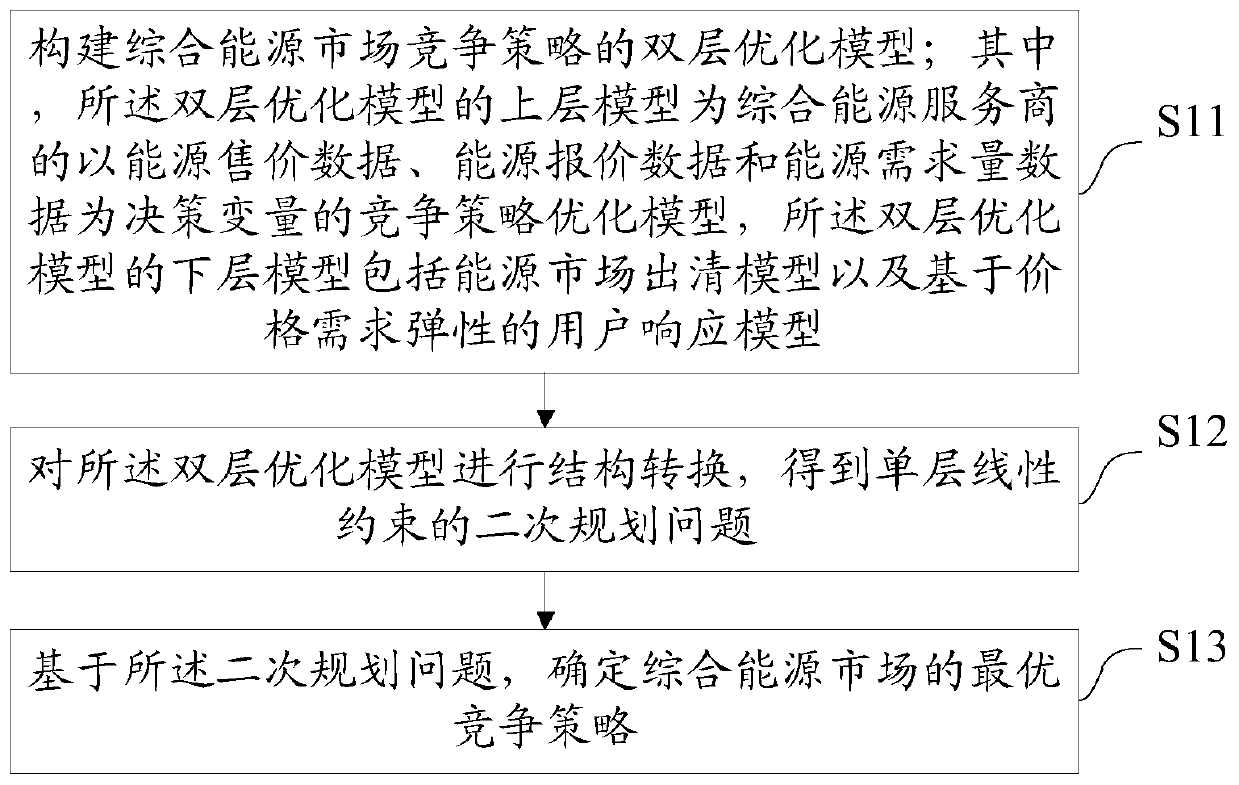

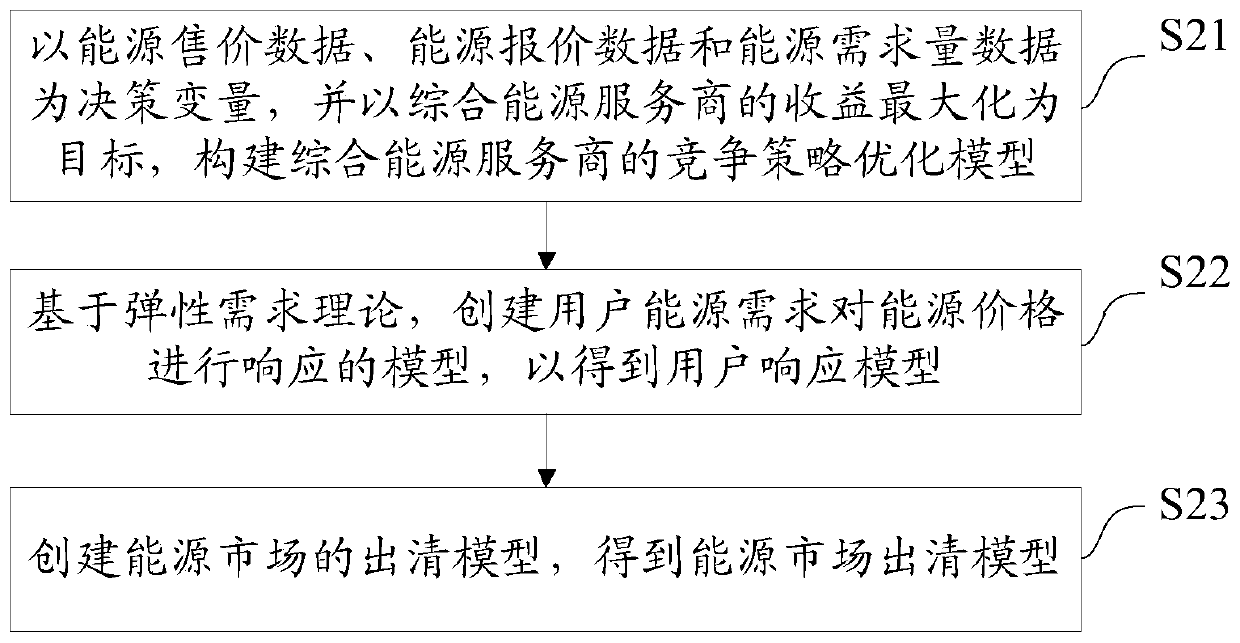

Comprehensive energy market competition strategy determination method, device and equipment and storage medium

InactiveCN109993366AImprove determination speedSimplified processing stepsForecastingResourcesBilevel optimizationSimulation

The invention discloses a comprehensive energy market competition strategy determination method, device and equipment and a storage medium. The method comprises the steps that a double-layer optimization model of a comprehensive energy market competition strategy is constructed; wherein the upper-layer model of the double-layer optimization model is a competition strategy optimization model whichtakes energy selling price data, energy quotation data and energy demand quantity data as decision variables for a comprehensive energy service provider, and the lower-layer model of the double-layeroptimization model comprises an energy market clearing model and a user response model based on price demand elasticity; performing structure conversion on the double-layer optimization model to obtain a single-layer linear constraint quadratic programming problem; and determining an optimal competition strategy of the comprehensive energy market based on the quadratic programming problem. By means of the technical scheme, the purpose of determining the optimal competition strategy of the comprehensive energy market is achieved, and the method has the advantages of being high in processing speed and high in precision.

Owner:ELECTRIC POWER RESEARCH INSTITUTE, CHINA SOUTHERN POWER GRID CO LTD +1

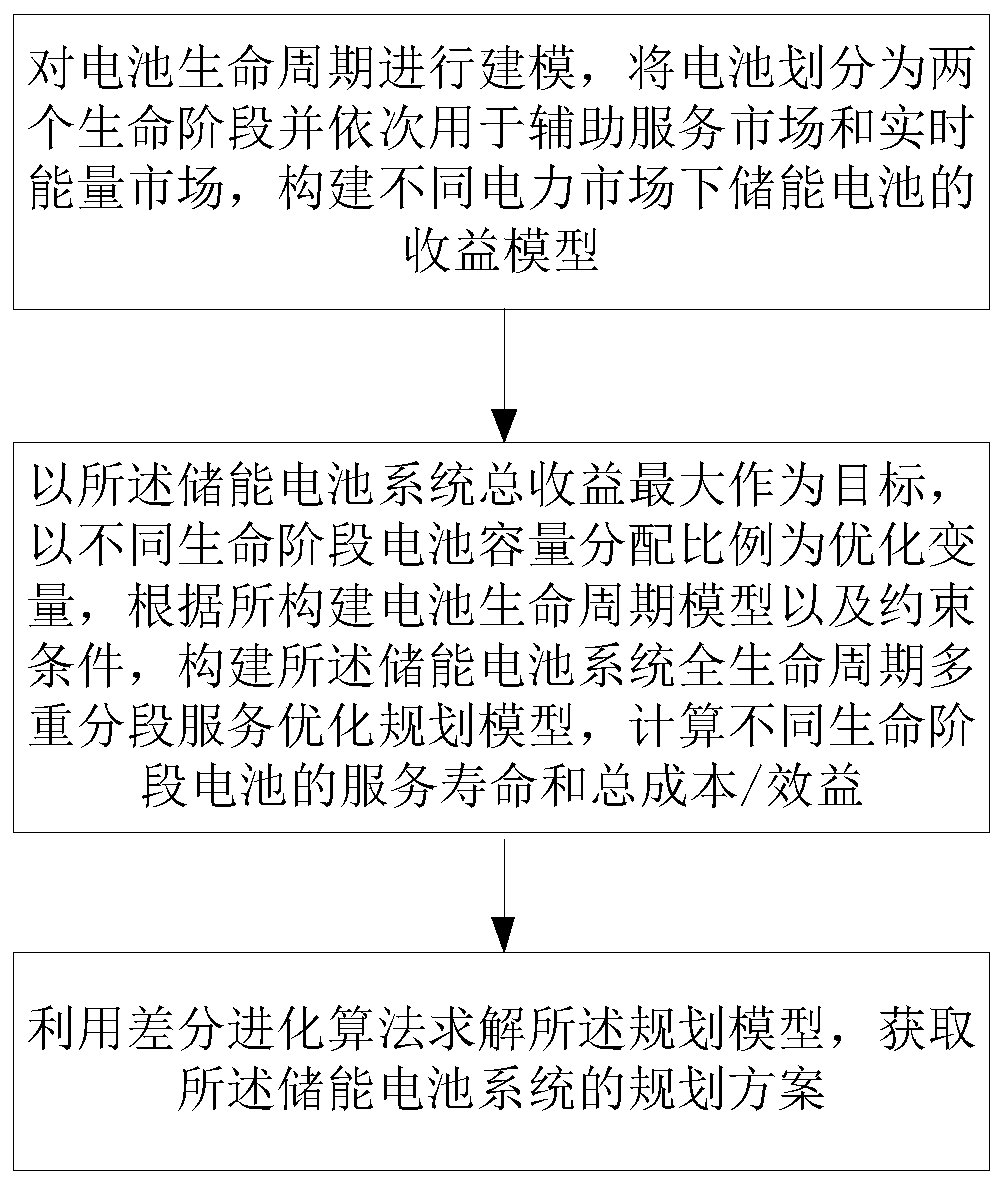

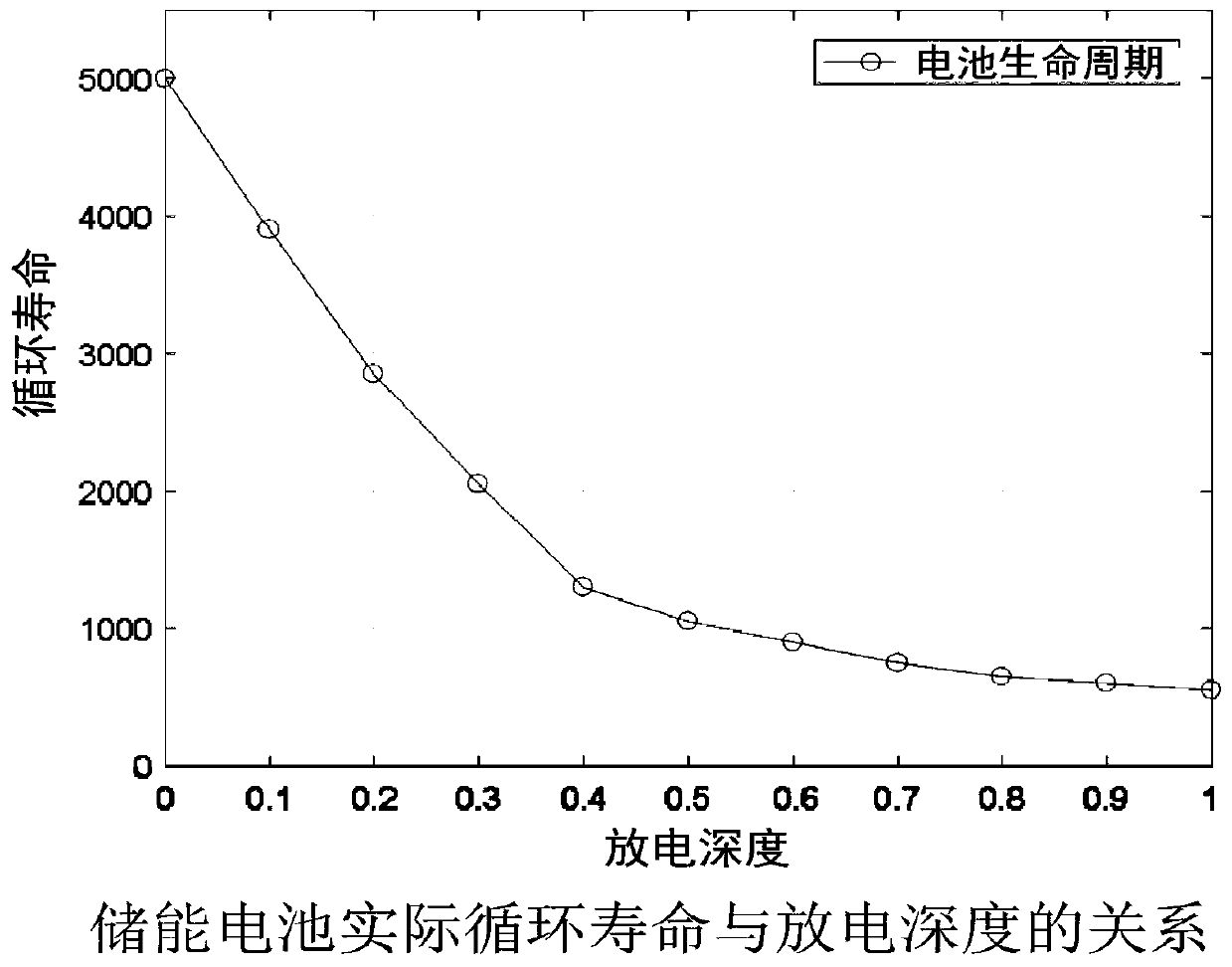

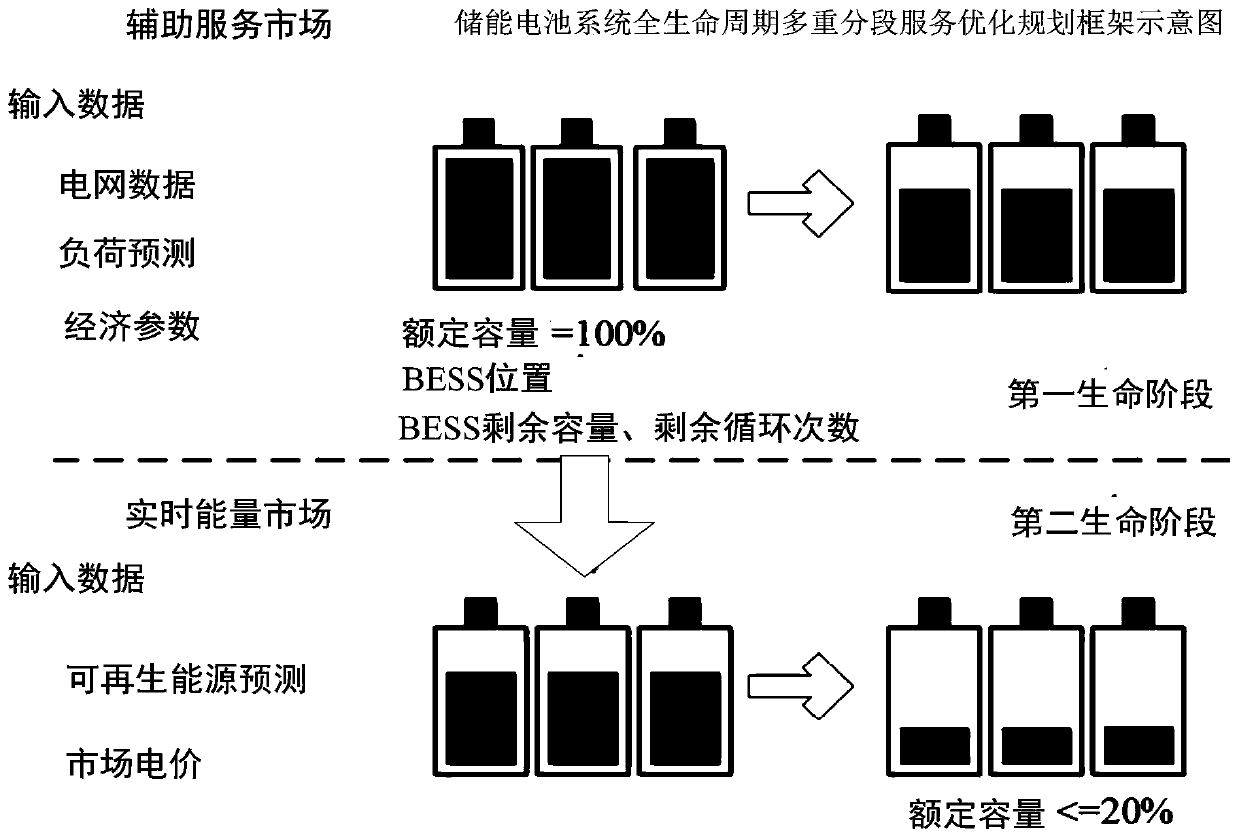

Full-life-cycle optimization planning method considering multi-segment service of energy storage battery

PendingCN110633854ATake advantage ofReduce pollutionSustainable waste treatmentForecastingFull life cycleElectricity market

The invention discloses a full-life-cycle optimization planning method considering multi-segment service of an energy storage battery, and the method comprises the steps: S1, modeling a battery lifecycle, dividing the battery life cycle into two life stages, enabling the two life stages to be sequentially used for an auxiliary service market and a real-time energy market, and building an incomemodel of the energy storage battery in different power markets; S2, taking the maximum total income of the energy storage battery system as a target; taking the battery capacity distribution proportions of different life stages as optimization variables, constructing a multi-segment service full life cycle optimization planning model of the energy storage battery system according to the constructed battery life cycle model and constraint conditions, and calculating the service life and the total cost / benefit of the batteries of different life stages; and S3, solving the planning model by usinga differential evolution algorithm to obtain a planning scheme of the energy storage battery system. The method helps investors to strategically distribute the energy of the energy storage battery todifferent markets so as to maximize the economic benefits of the investors and ensure the effective service life of the battery.

Owner:CHANGSHA UNIVERSITY OF SCIENCE AND TECHNOLOGY

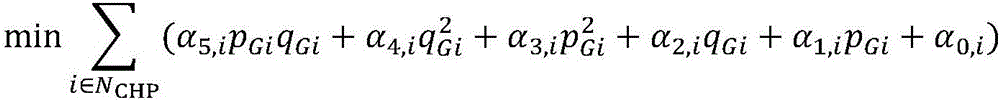

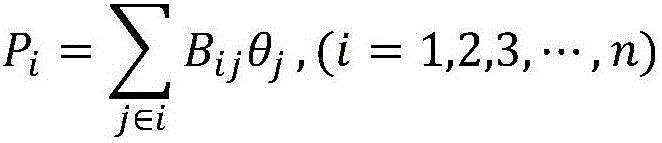

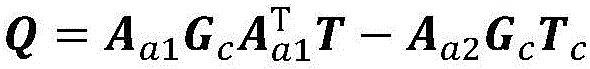

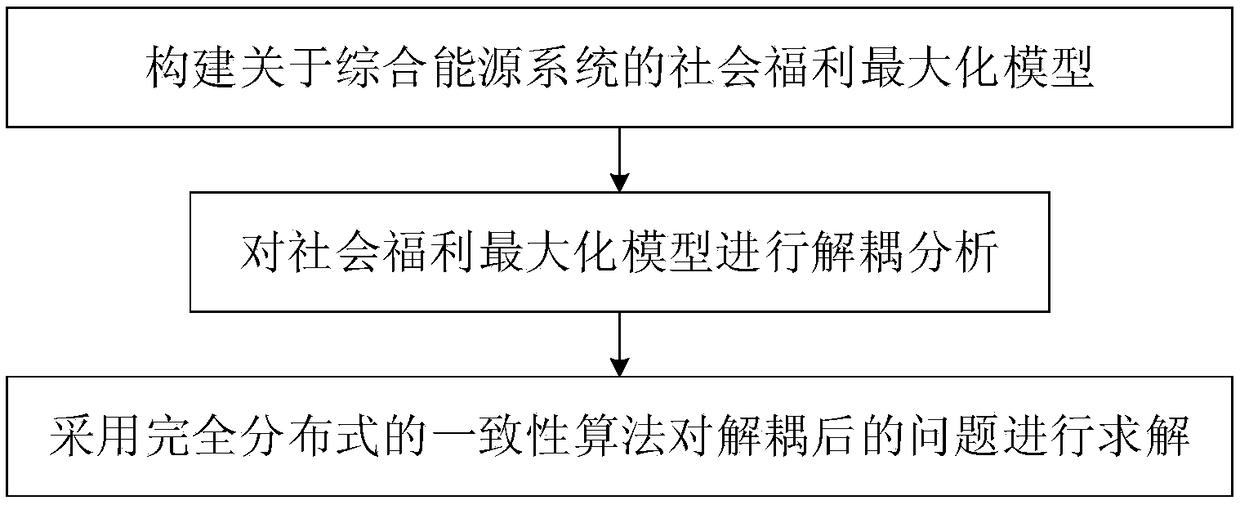

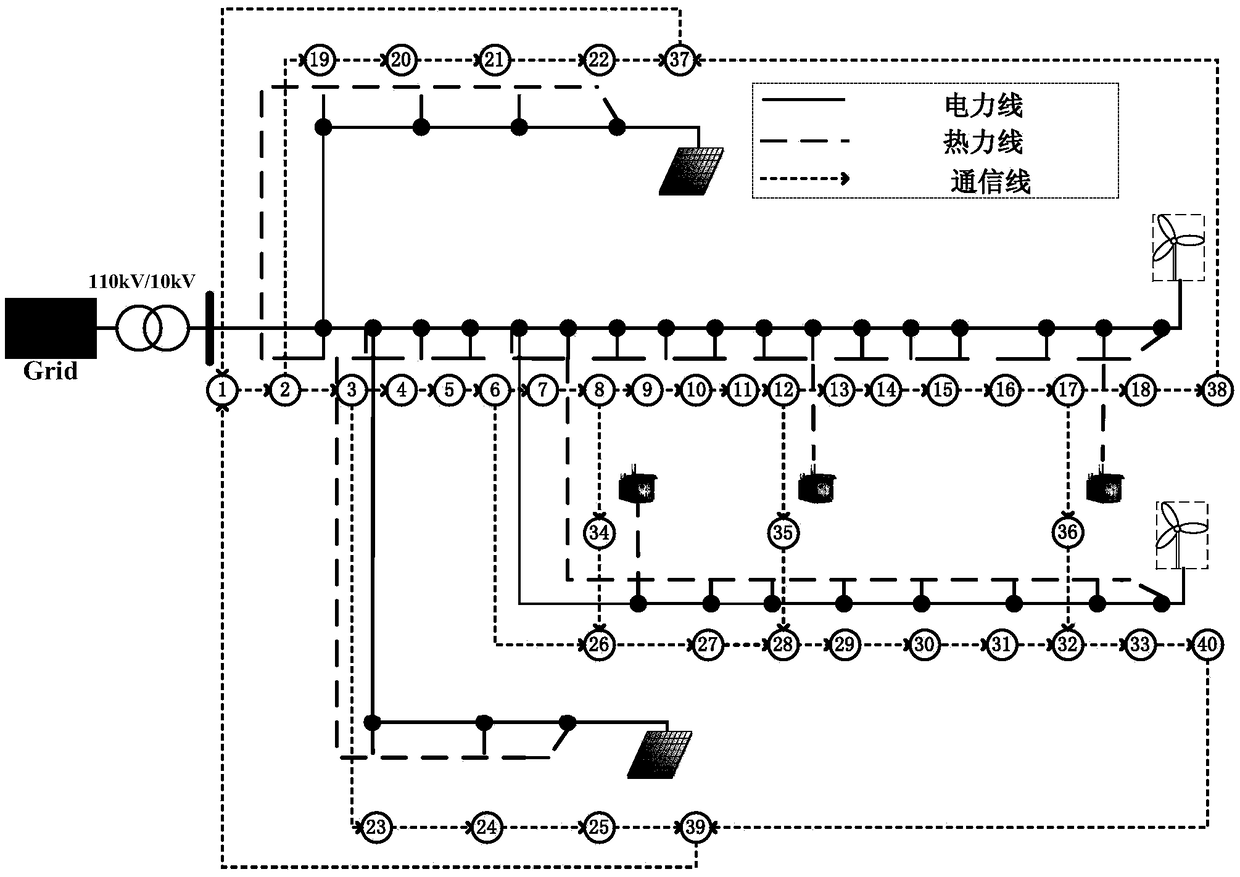

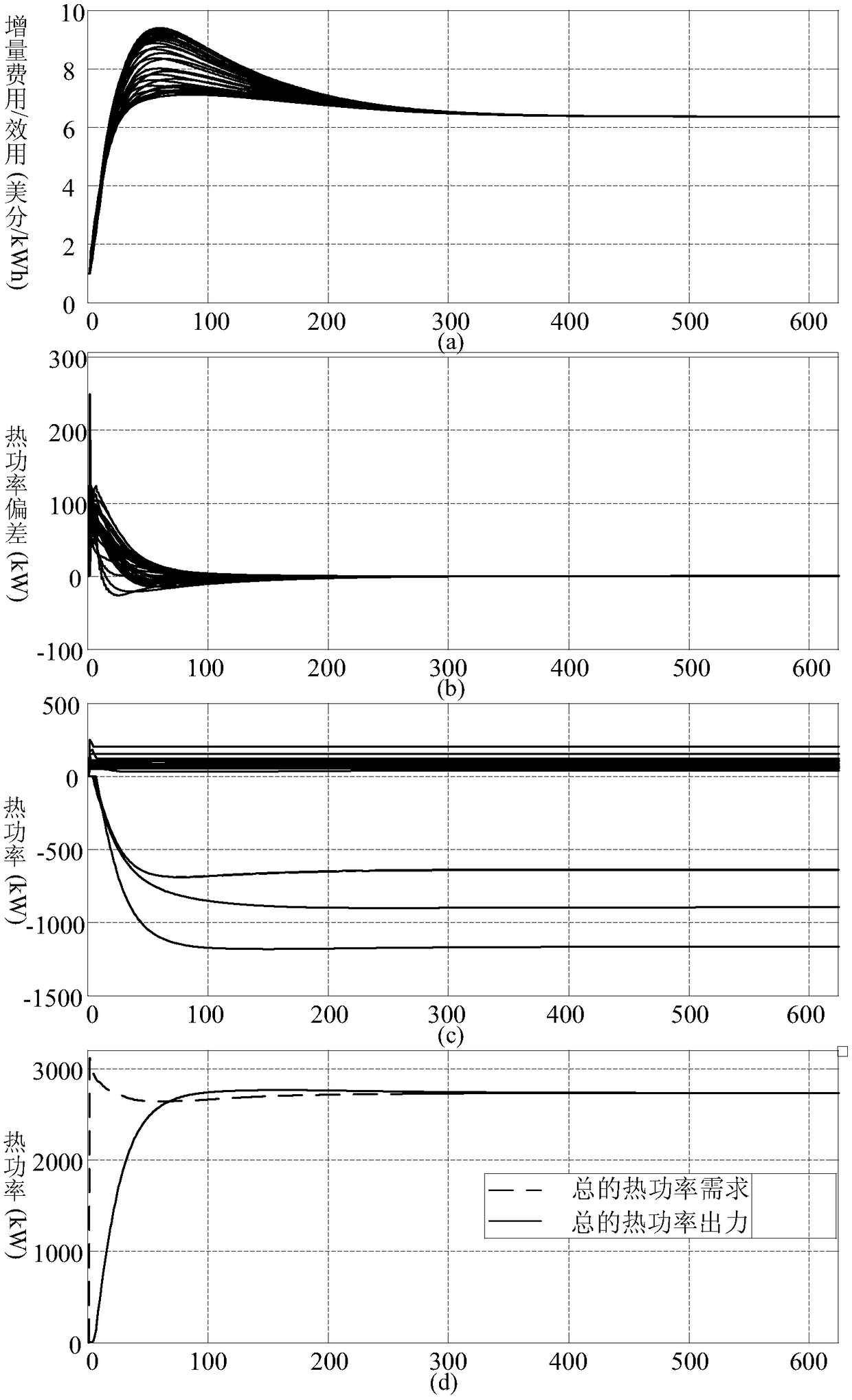

An energy management method of integrated energy system based on consistency

ActiveCN109193628AGuaranteed privacyImprove operational efficiencyPower network operation systems integrationSingle network parallel feeding arrangementsIntegrated energy systemEngineering

The invention provides an energy management method of an integrated energy system based on consistency. Participants of a heat power grid, a power grid, an energy supply side and a load demand side all participate in an energy market to pursue their own benefit maximization and constitute a whole social welfare maximization model. The CHP unit operates in an improved operation strategy, in which both the electric load and the thermal load are involved in the demand response. The original optimization problem is decomposed into four sub-problems which are composed of local constraints and objective functions after decoupling the global power balance by Lagrange multiplier method, so it is suitable to use the fully distributed consistency algorithm to solve the problem. The method fully considers the thermoelectric coupling on the power supply side and the thermoelectric coupling on the load side, and the complete distributed solution has high efficiency on the basis of guaranteeing theprivacy of users, which has a good guiding significance for the distributed energy management of the future integrated energy system in the distribution network level.

Owner:NORTH CHINA ELECTRIC POWER UNIV (BAODING)

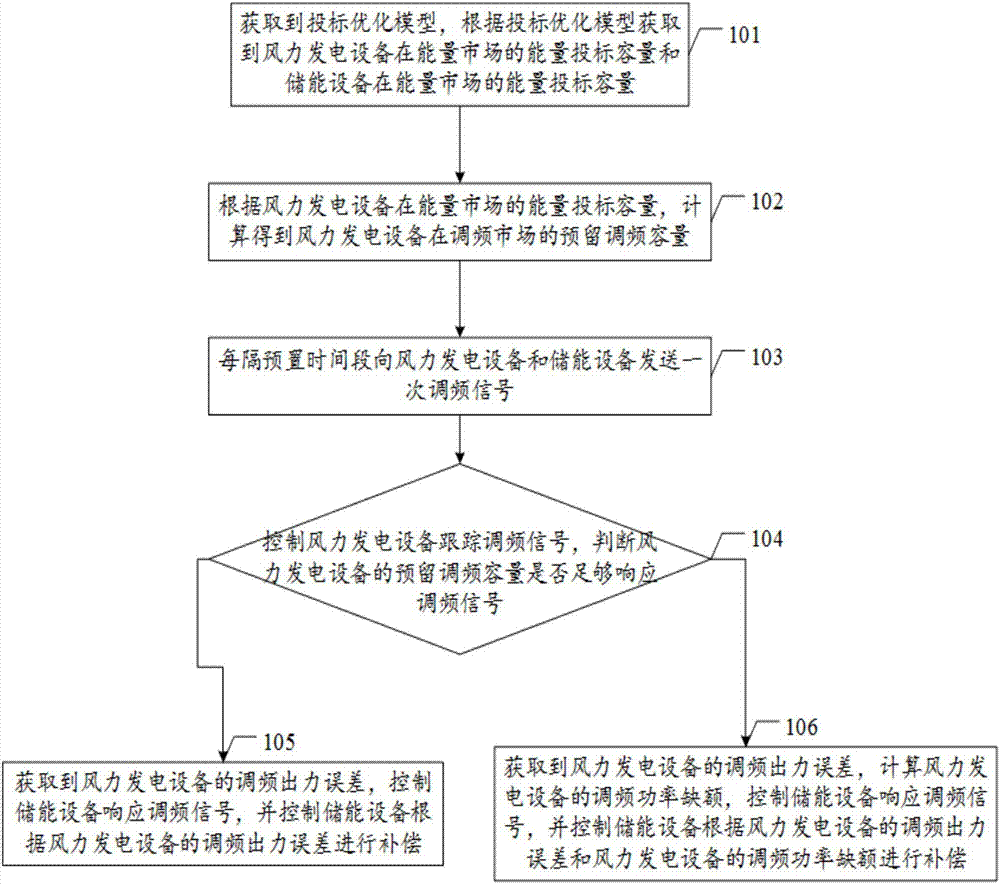

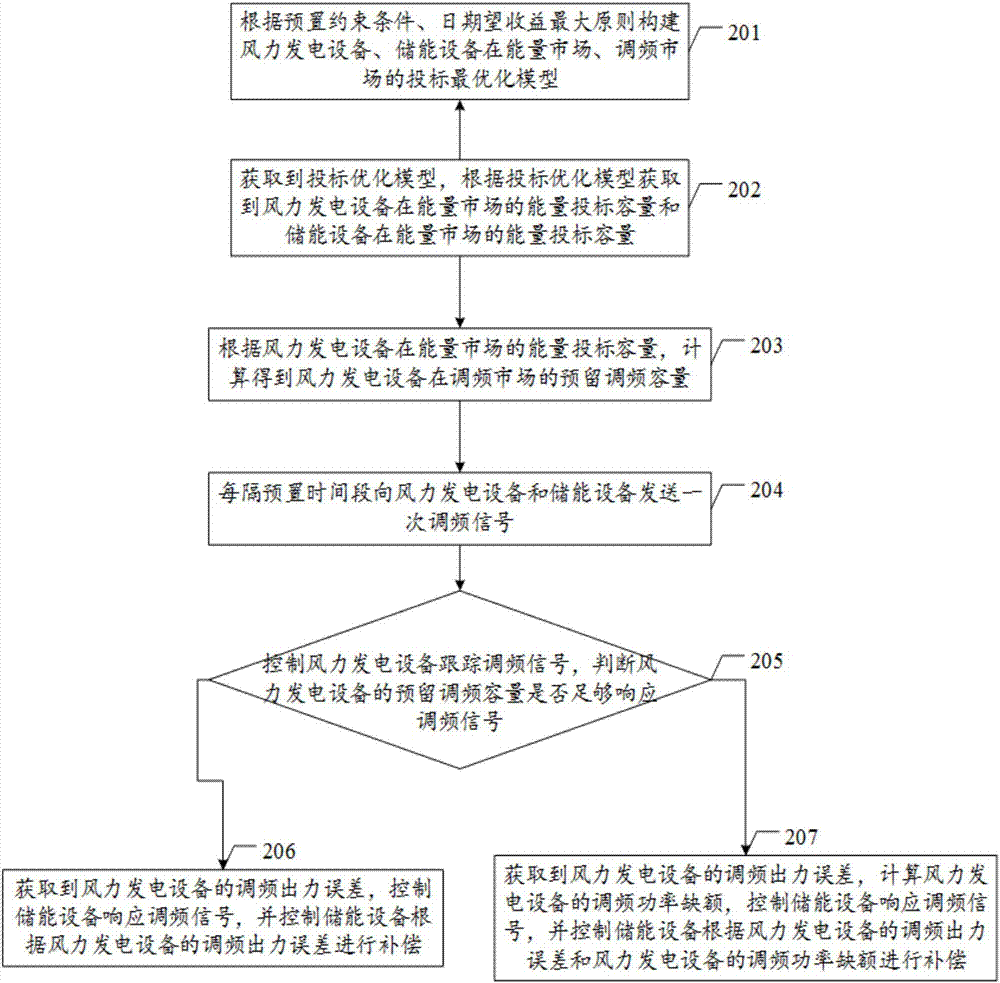

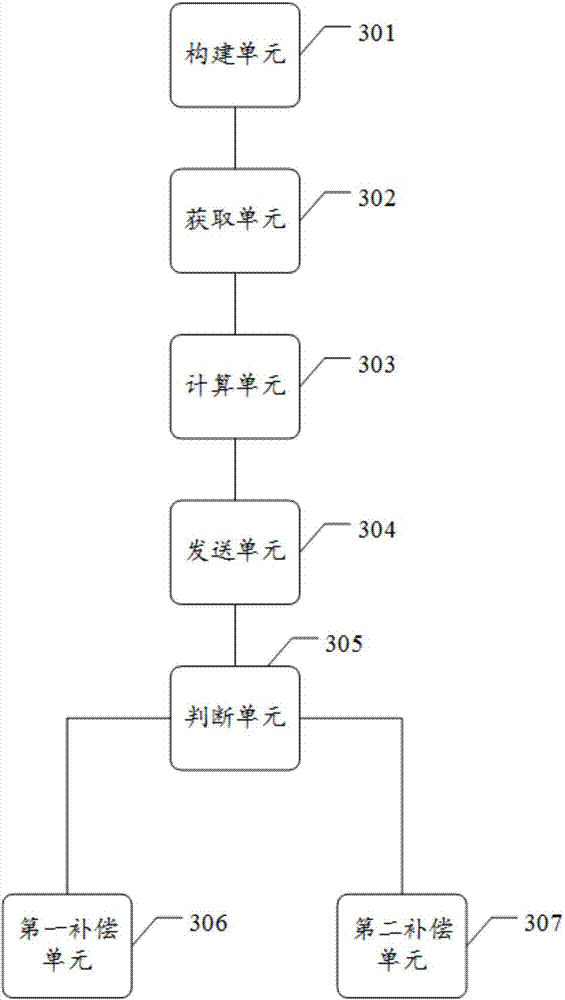

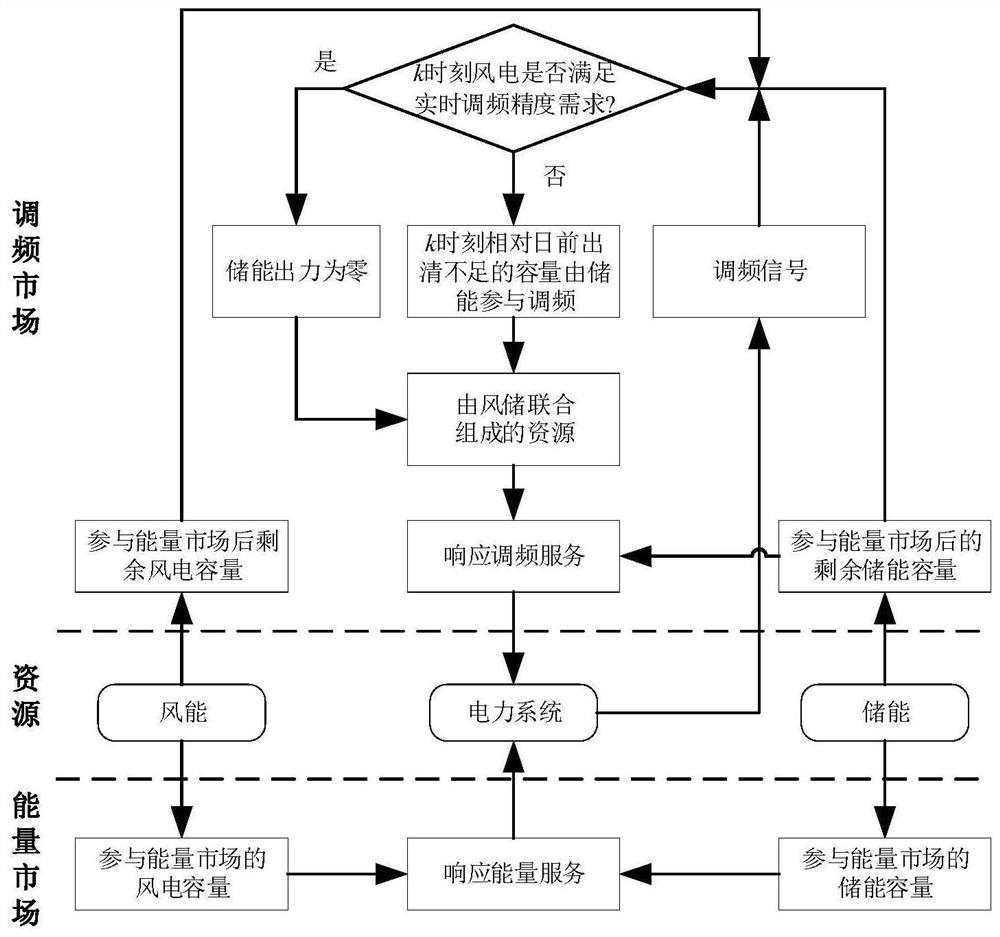

Wind storage combined frequency-modulation operation mode and multi-market bidding and control method and system

ActiveCN107248749AGive full play to the complementary advantages of precision and durabilityEffectively undertake FM servicesPower oscillations reduction/preventionUltrasound attenuationPower grid

The embodiment of the invention discloses a wind storage combined frequency-modulation operation mode and a multi-market bidding and control method and system. Aiming at the defects of wind power and energy storage during the frequency modulation process, a wind power and energy storage combined frequency modulation operation mode is designed by applying complementary characteristics of accuracy and durability of wind power and energy storage in providing frequency modulation service. A bidding optimization model of a wind storage combination body in energy market and frequency modulation market is built to achieve maximum benefit, a control strategy that wind power frequency modulation is preferably controlled and the battery energy storage is used for compensating insufficient frequency modulation output and a frequency modulation deviation processing part to achieve accurate control on a frequency, the attenuation on energy storage lifetime of a battery is reduced, and the frequency modulation pressure of a power grid in future is relieved. Based on effective guidance significance, wind power, energy storage plan and an operator can organize wind power and energy storage to participate in frequency modulation market according to the wind storage combined frequency-modulation operation mode.

Owner:ELECTRIC POWER RES INST OF GUANGDONG POWER GRID

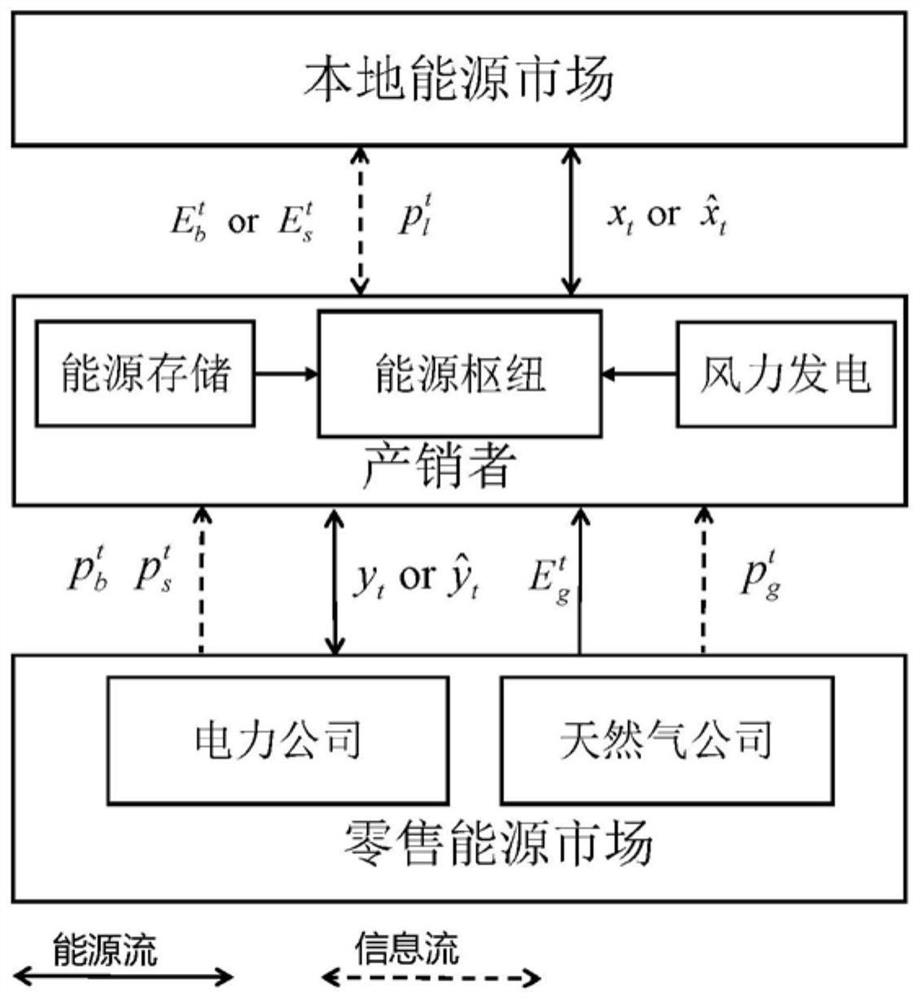

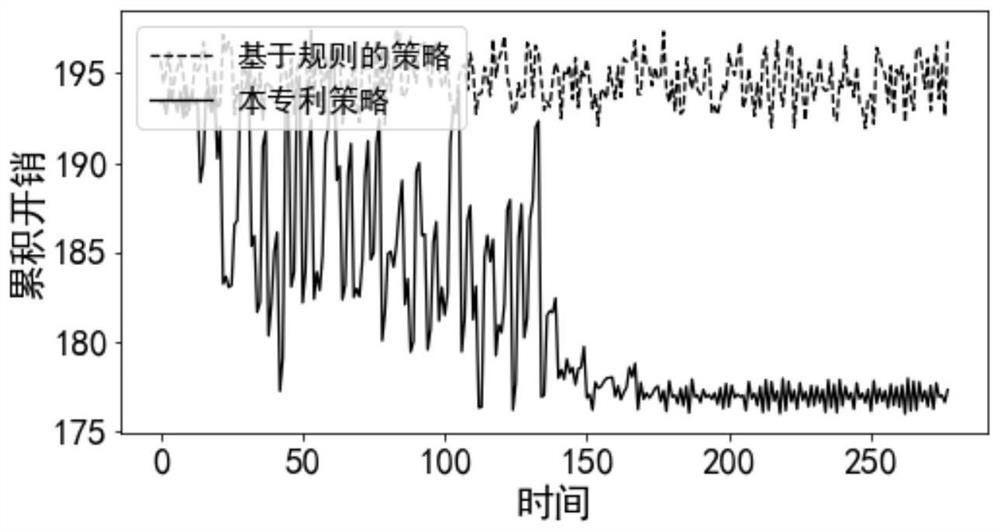

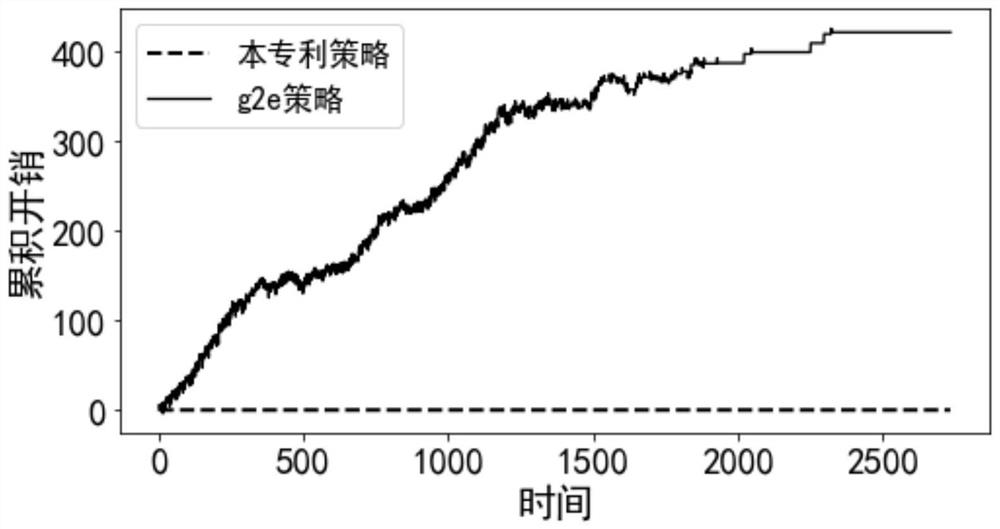

Multi-energy system energy scheduling method based on deep reinforcement learning

ActiveCN111815369AEfficient use ofReduce energy costsMarket predictionsFinanceMarket placeFinancial transaction

The invention discloses a multi-energy system energy scheduling method based on deep reinforcement learning, and relates to the field of intelligent power grids. The method comprises the following steps that: step 1, before each transaction is started, a producer and seller selects an effective transaction action according to the energy price of a retail energy market, own energy requirements, energy storage and the historical transaction average price of a local energy market in a current transaction period; 2, the producer and salesman obtains the actual transaction volume in the retail energy market and the local energy market according to the effective transaction action; 3, the producer and salesman calculates the income or overhead of the current transaction period according to the actual transaction volume; 4, the producer and seller updates a transaction strategy according to experience, and enters the next transaction period; and step 5, the above steps are repeated until a stable transaction strategy is obtained. According to the scheme, effective conversion between energy can be achieved, the energy utilization rate is increased, and long-term benefits of producers and marketers are increased.

Owner:SHANGHAI JIAO TONG UNIV

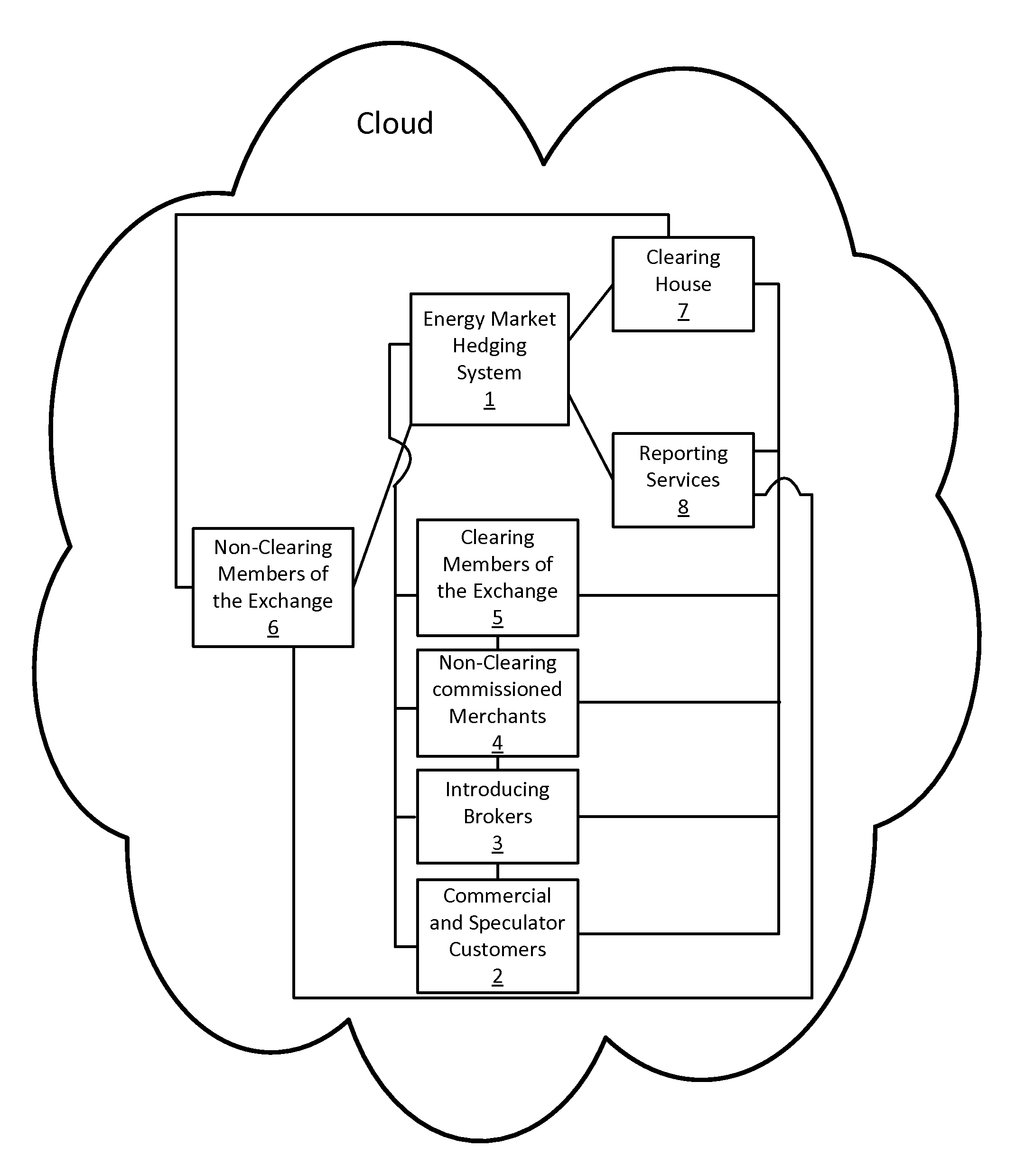

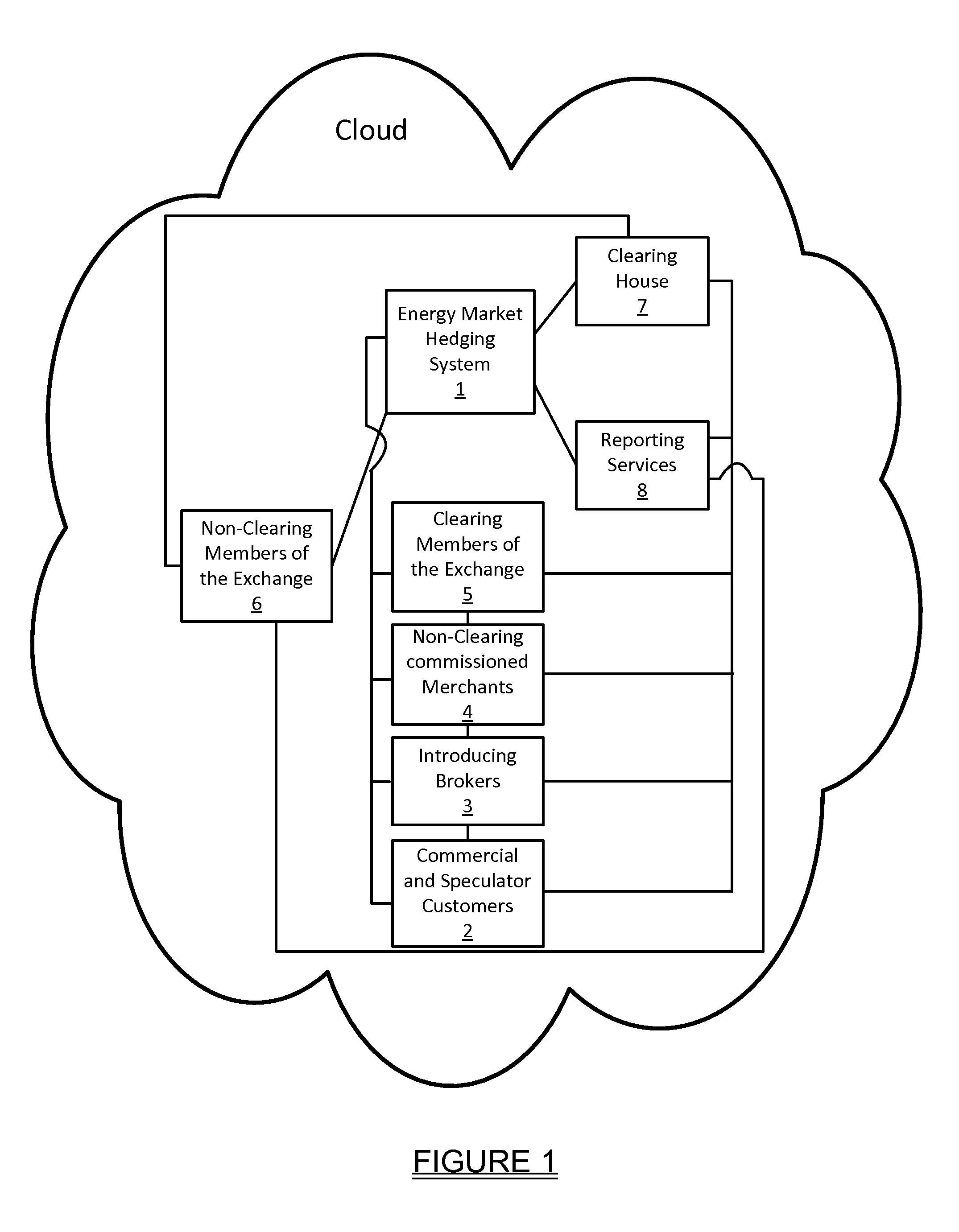

System and Method For Sharia-Based Energy Market Hedging And Related

ActiveUS20150221032A1Easily tradableIncrease flexibilityFinanceFinancial transactionComputer science

A tradable asset market trading and hedging system is disclosed. The tradable assets may include fuels or industrial minerals and rocks (IMRs). The system may include a conventional Exchange and its Islamic exchange affiliate or subsidiary (“IES”), a Sharia conversion module (both hardware and software), and a back-to-back order execution module (also both hardware and software). The IES makes use of a suitable cross-liquidity algorithm for the purpose of consolidating bids and offers from the Exchange and the IES in order to enhance IES liquidity. An entity that qualifies for Sharia-based trading with the IES may be issued a customized dongle to inter alia regulate and control who can access what data at any given time. The dongle interfaces with a computing device (e.g., laptop, desktop, tablet, etc.) used by an individual, institution or other qualified entity to access the IES. The dongle may include a customer position limits enforcement module and a high frequency trading order stuffing block module that are both in communication with a suitable processor. The system and method enables Sharia-compliant trades to be executed, including those trades that are attendant to Islamic-financed transactions.

Owner:DEARBORN FINANCIAL

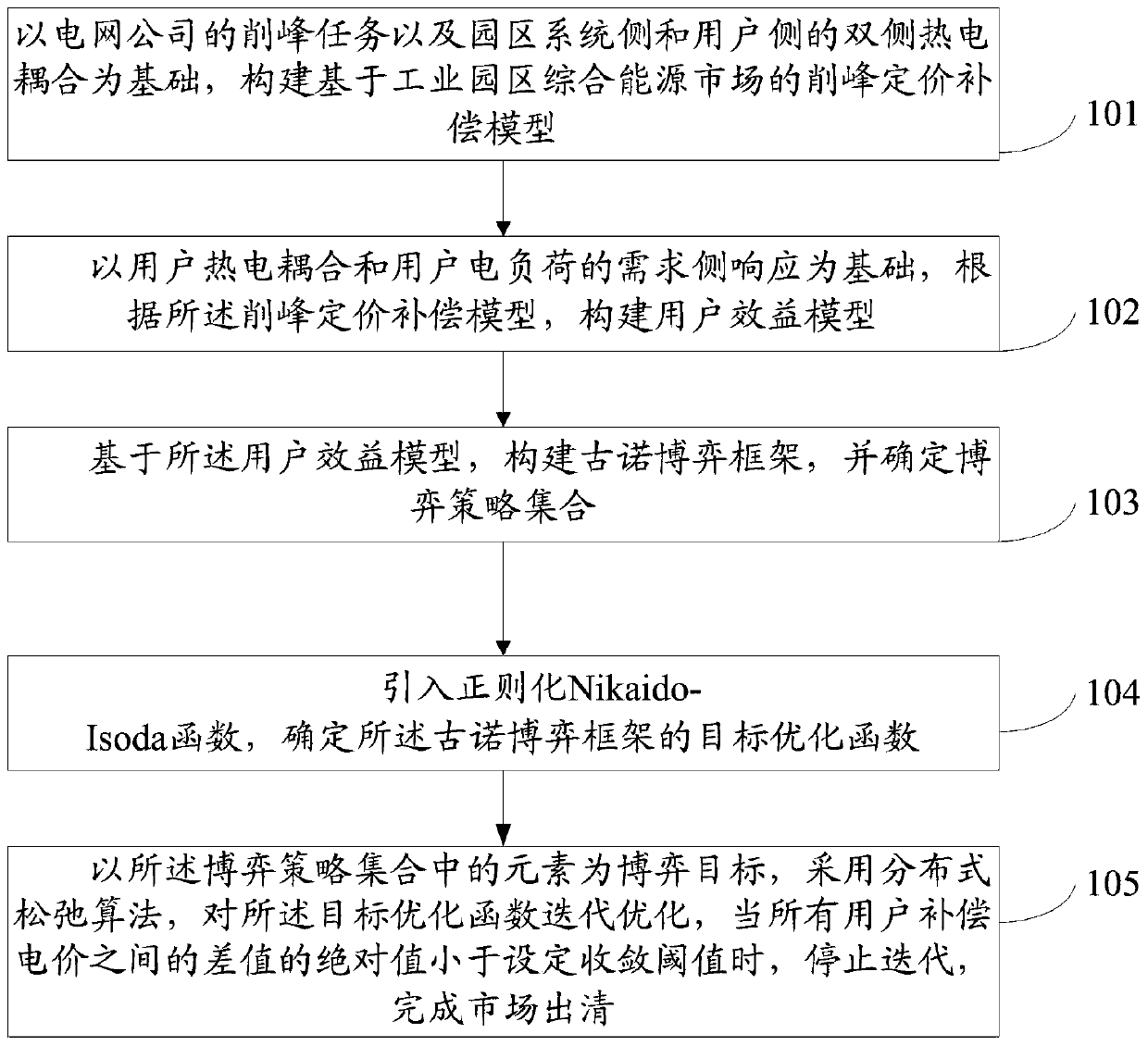

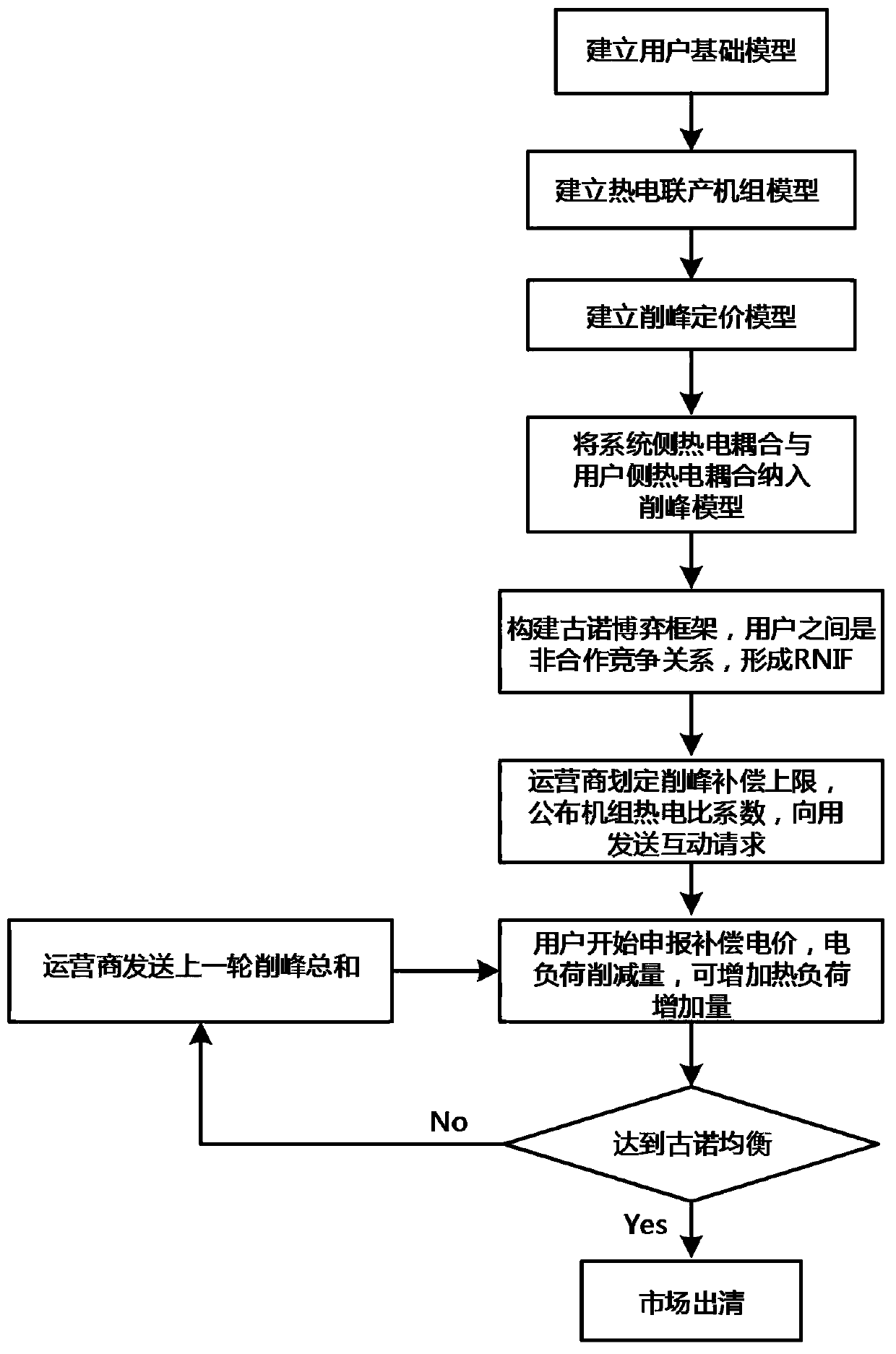

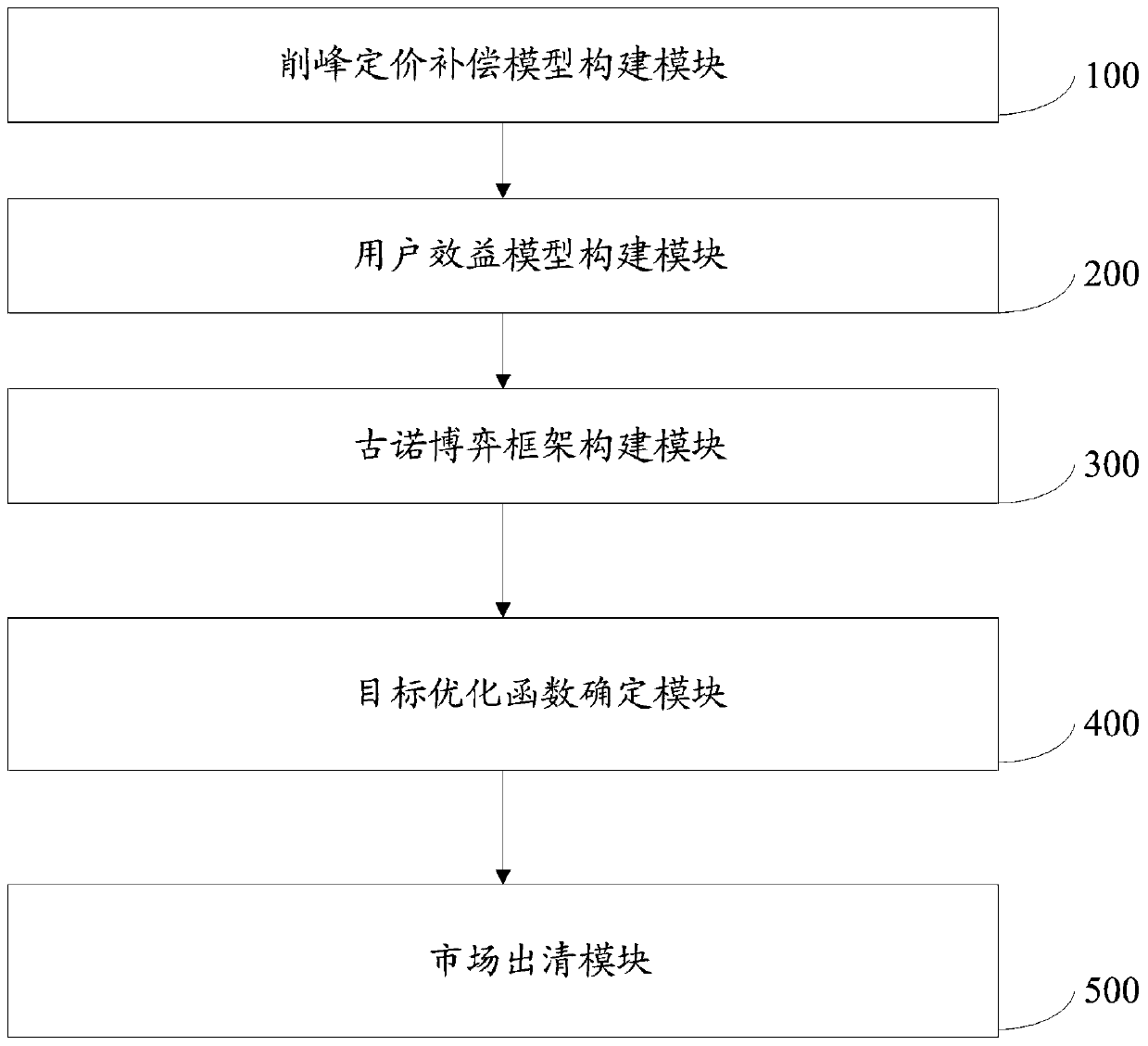

A method and a system for balancing a comprehensive energy market in an industrial park

InactiveCN109919371AMeet the demand for economical energy useLow costEnergy industryForecastingElectricity marketCoupling

The invention discloses a method and a system for balancing a comprehensive energy market in an industrial park. The method mainly comprises the following steps: constructing a peak clipping and pricing compensation model based on an industrial park comprehensive energy market; secondly, after the research on the cournot game of the power market in the past is referenced, establishing a user benefit model and an interactive game mechanism for multiple subjects in the industrial park, considering double-side thermoelectric coupling of a system side and a user side of the park, incorporating thedouble-side thermoelectric coupling into a game target between users, and constructing a regularized Nikaido-Isoda function and using a distributed relaxation algorithm to solve it optimally, and obtaining the equilibrium point of the integrated energy market. By applying the method and the system, not only can the requirements of all users in the industrial park be met, but also the user cost iseffectively saved, and the utilization rate of energy is improved.

Owner:NORTH CHINA ELECTRIC POWER UNIV (BAODING)

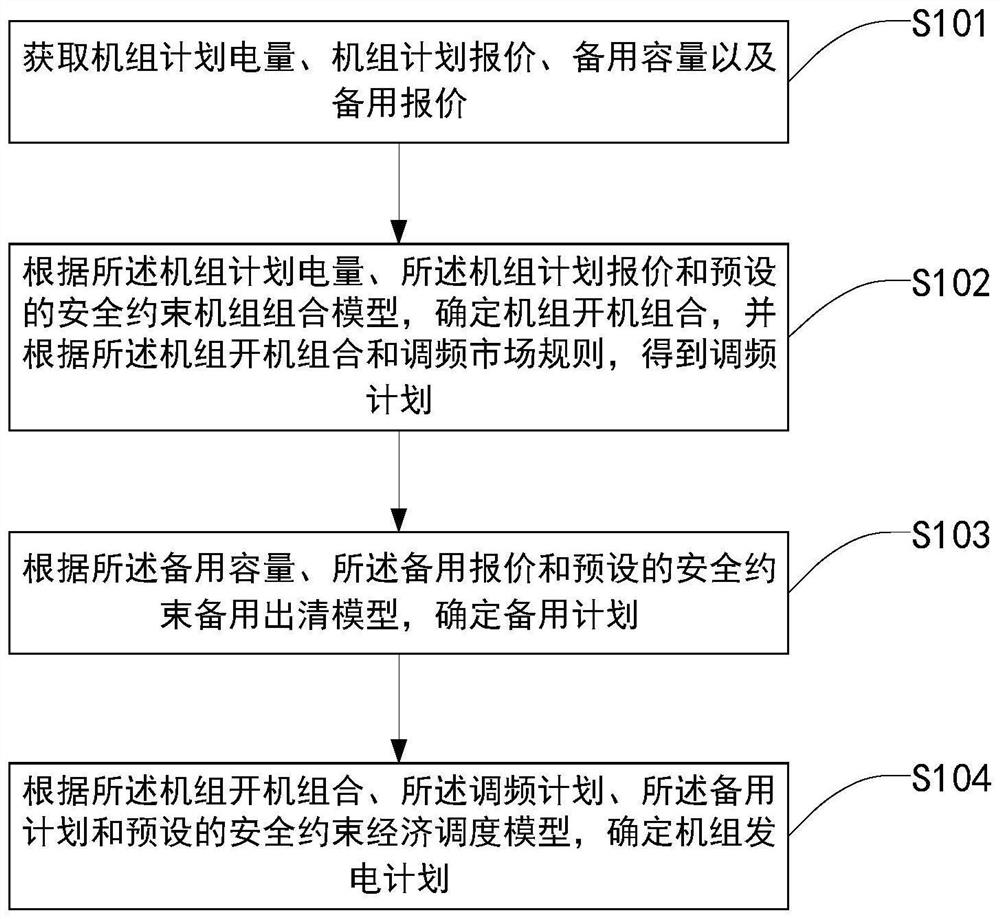

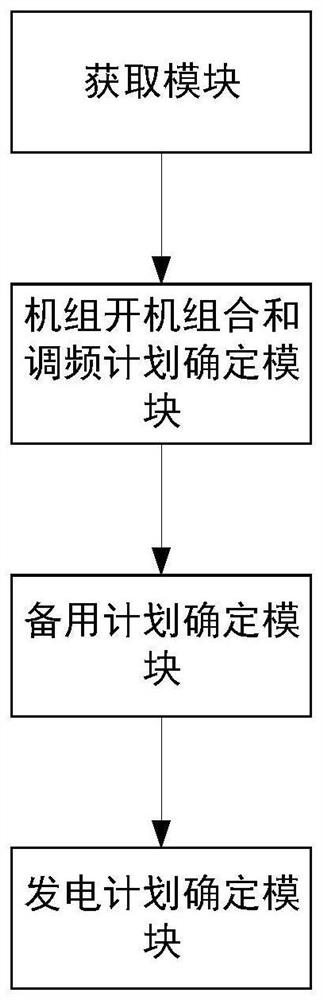

Day-ahead power spot market clearing method, system and device and storage medium

PendingCN111654020AGuaranteed uptimeImprove power generation efficiencyResourcesSystems intergating technologiesMarket placeCapacity market

The invention discloses a day-ahead power spot market clearing method, system and device and a storage medium. The method comprises the steps of determining a unit startup combination through a safetyconstraint unit combination model, and obtaining a frequency modulation plan according to the unit startup combination and a frequency modulation market rule; determining a standby plan according tothe standby capacity, the standby quotation and the security constraint standby clearing model; and determining a unit power generation plan according to the unit startup combination, the frequency modulation plan, the standby plan and the safety constraint economic dispatching model. According to the embodiment of the invention, the standby capacity market which is relatively independent from theelectric energy market and the frequency modulation market is constructed, the real-time condition of the standby capacity is fully considered, and standby resources can be efficiently scheduled, sothat a reasonable, reliable and high-executability power generation plan is obtained, the stable operation of a power system is ensured, the power generation efficiency of the power system is improved, and the method can be widely applied to the technical field of power markets.

Owner:CHINA SOUTHERN POWER GRID COMPANY

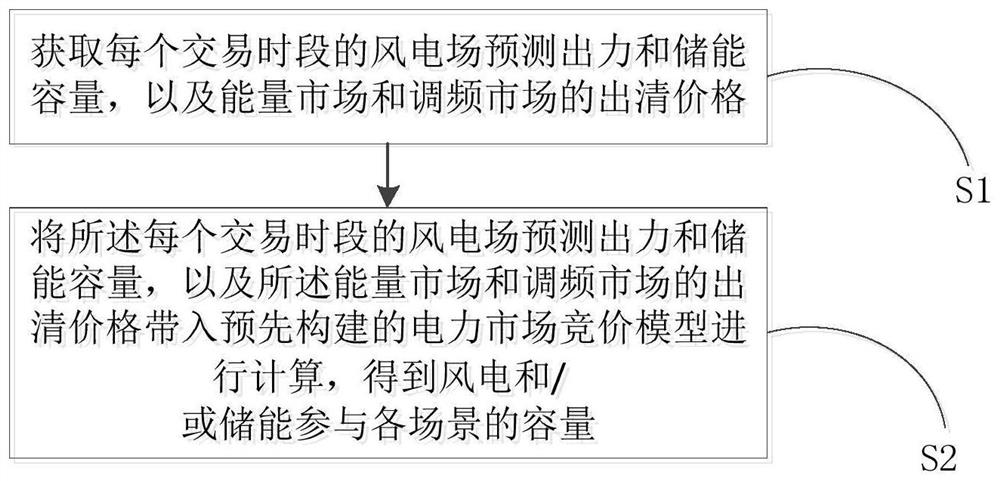

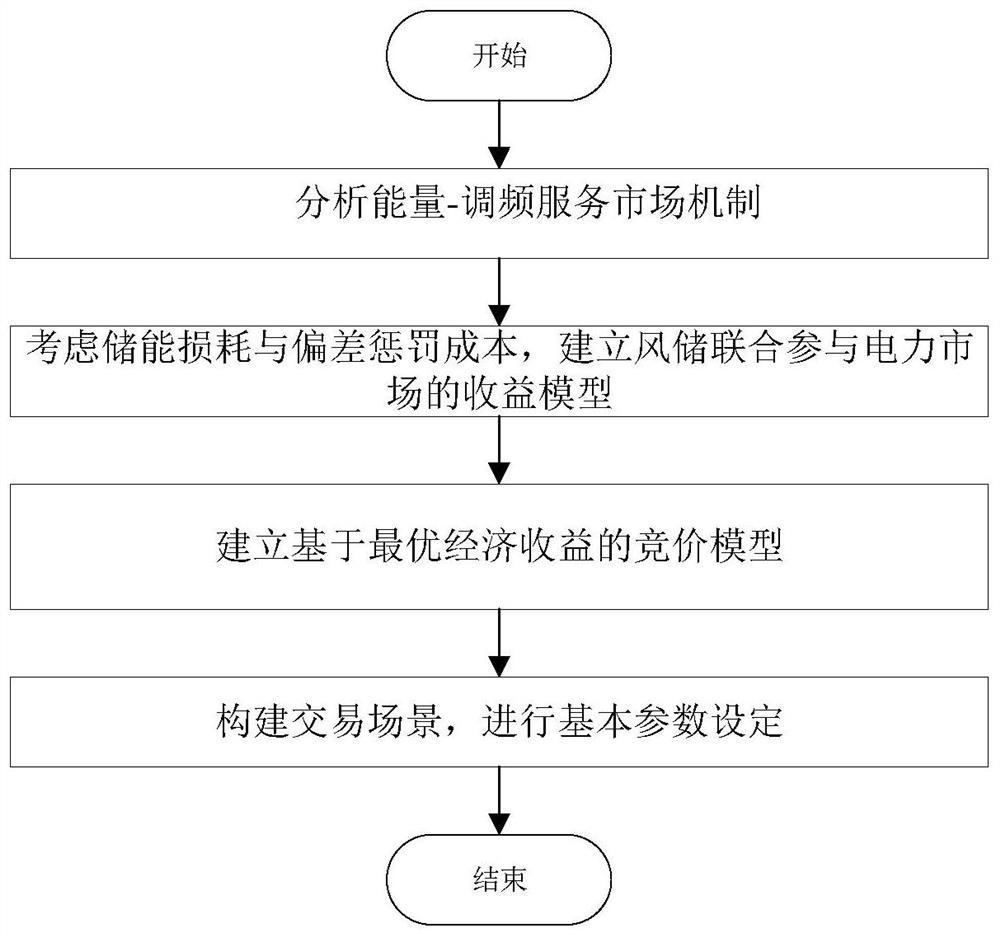

Optimal bidding method and system for wind storage joint participation in energy-frequency modulation market

PendingCN112001528AImprove FM capabilityReduce loss costMarket predictionsForecastingStored energyFrequency modulation

The invention discloses an optimal bidding method and system for wind storage joint participation in an energy-frequency modulation market. The bidding method comprises the steps of obtaining predicted output and energy storage capacity of a wind power plant in each transaction time period, and clearing prices of the energy market and the frequency modulation market; substituting the predicted output and the energy storage capacity of the wind power plant in each transaction period and the clearing prices of the energy market and the frequency modulation market into a pre-constructed electricity market bidding model for calculation to obtain the capacity of wind power and / or energy storage participating in each scene; wherein the scene comprises a wind power participation energy market, anenergy storage participation energy market, a wind storage joint participation frequency modulation market and an energy storage participation frequency modulation market; wherein the electricity market bidding model is constructed by taking the optimal income when wind power and / or energy storage participates in each scene as a target. According to the invention, the frequency modulation performance of wind power is effectively improved, and the energy storage loss cost is reduced to a certain extent.

Owner:CHINA ELECTRIC POWER RES INST +2

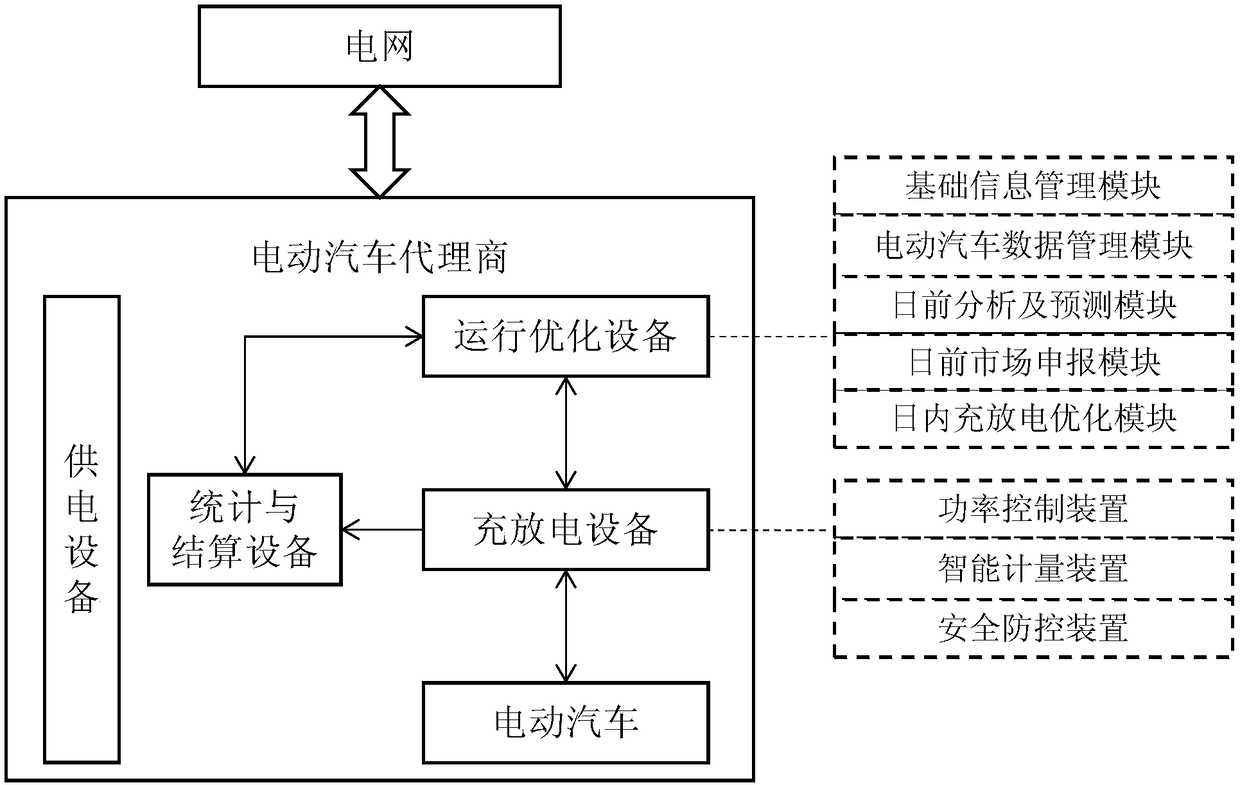

Intelligent control system with electric vehicle agent participating in energy market and frequency modulation market

ActiveCN108448567AOptimization StrategyVersatileCharging stationsElectric powerReal-time chargingCost effectiveness

The invention discloses an intelligent control system with an electric vehicle agent participating in an energy market and a frequency modulation market. The intelligent control system includes powersupply equipment, operation optimization equipment, charging and discharging equipment and statistics and settlement equipment, wherein the power supply equipment is used for supplying power to the operation optimization equipment, charging and discharging equipment and statistics and settlement equipment; the operation optimization equipment is used for providing an optimal quotation strategy ofcurrently participating in the energy market and the frequency modulation market and a real-time charging and discharging optimization strategy of an electric vehicle for an electric vehicle agent, and performing information interaction with a power grid, the charging and discharging equipment and the statistics and settlement equipment; the charging and discharging equipment is used for controlling charging and discharging power of the electric vehicle; and the statistics and settlement equipment is used for making a statistical analysis of cost effectiveness of the electric vehicle agent participating in the market and forming a settlement bill of the electric vehicle. The system provided by the invention has a clear structure, complete functions and excellent operation performance, caneffectively improve the total revenue of the electric vehicle agent, and promote optimizing configuration of resources.

Owner:SOUTH CHINA UNIV OF TECH

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com