Patents

Literature

71results about How to "Reduce credit risk" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

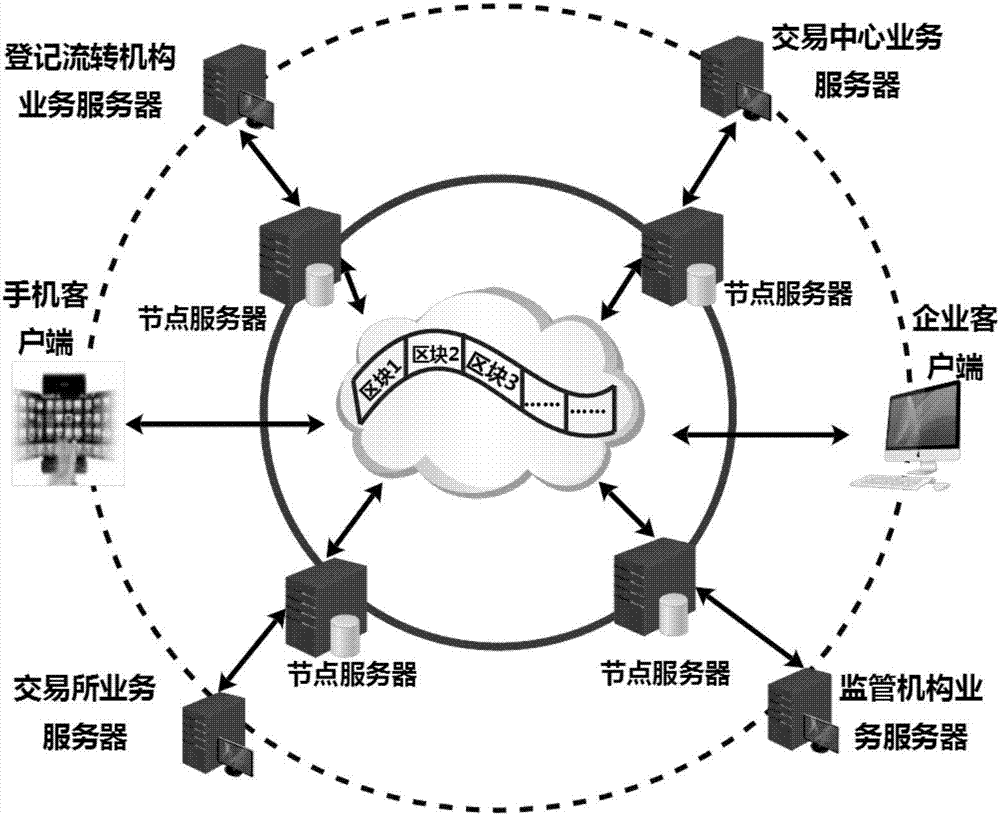

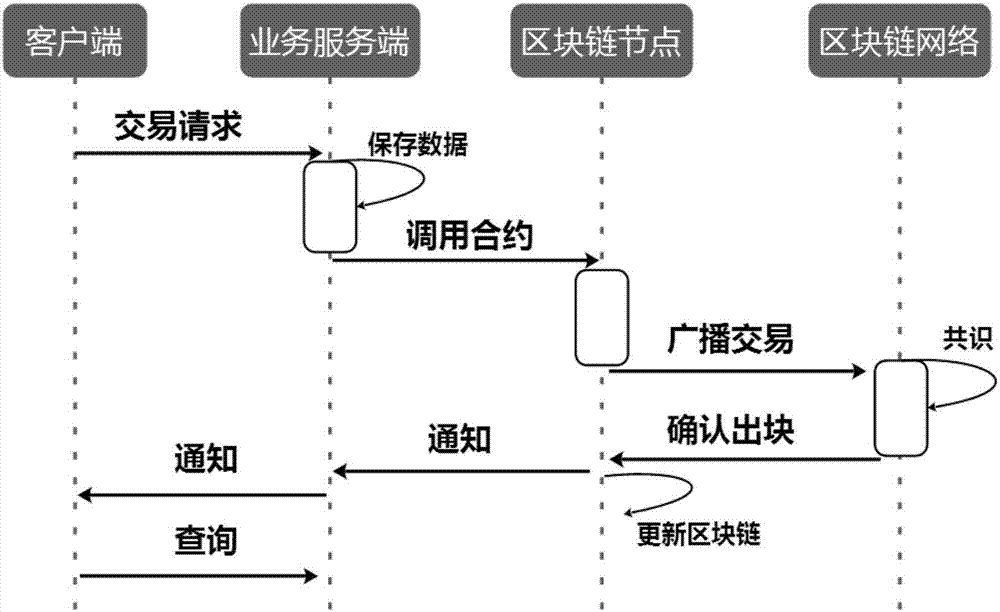

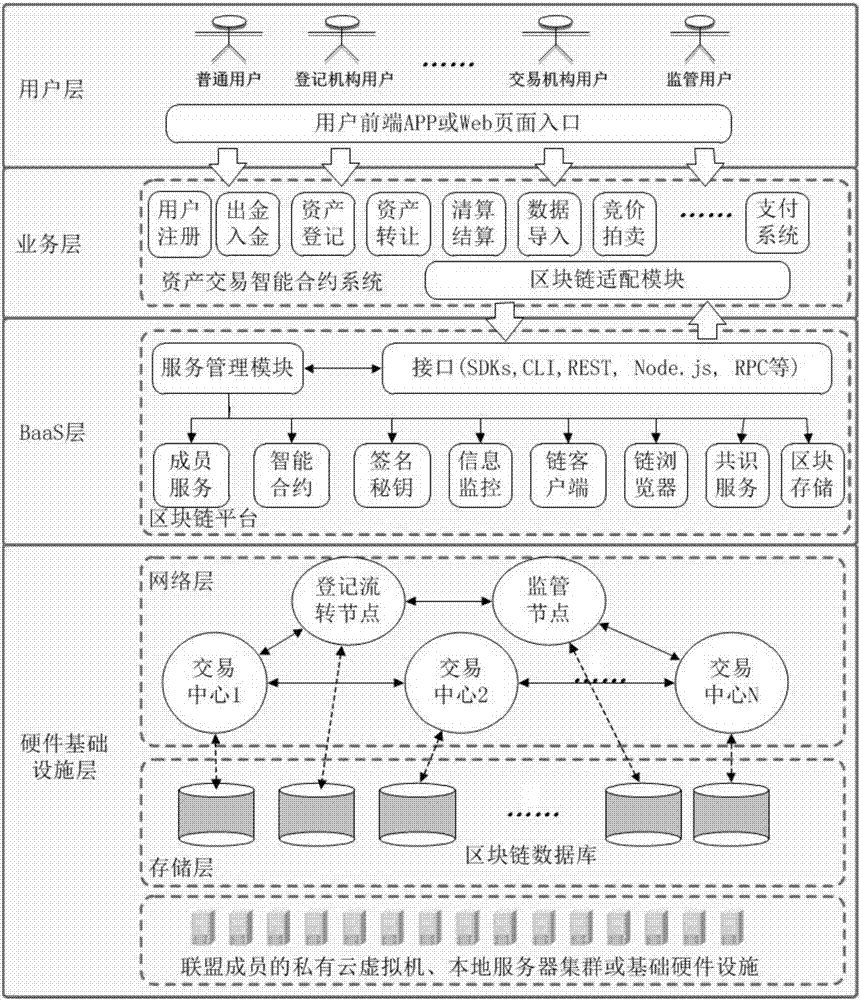

Method for constructing financial asset trading system based on alliance chain

InactiveCN107025602AProtect interestsReduce credit riskFinanceElectronic credentialsData miningComputer science

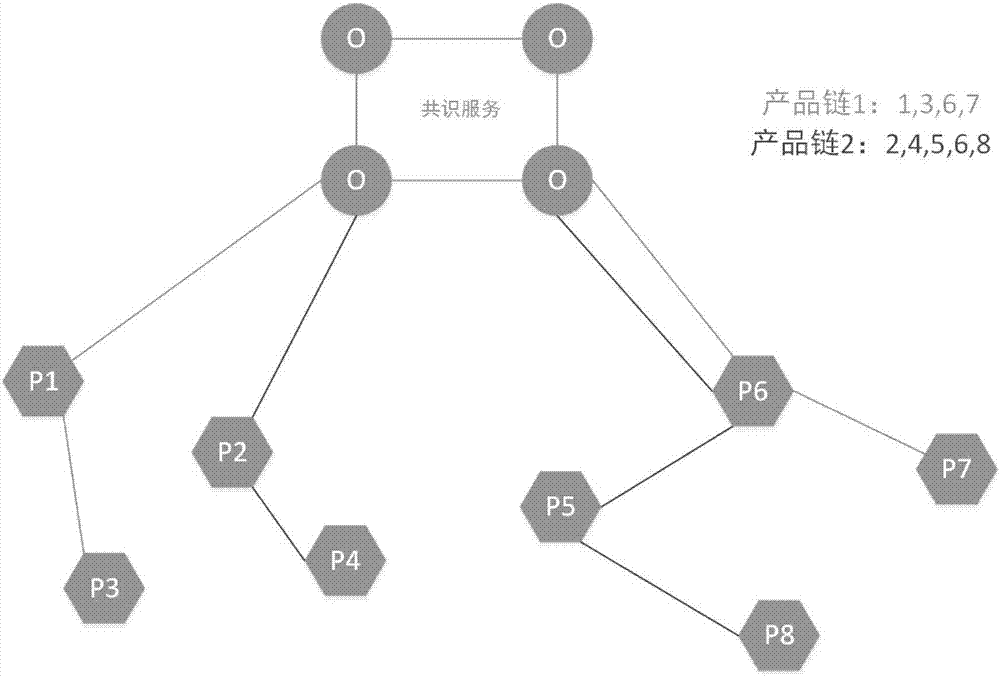

The invention discloses a method for constructing a financial asset trading system based on an alliance chain. With an alliance chain as a technical support, a novel financial asset digital unique certificate is provided based on the existing laws and regulations. The system uses a distributed technology architecture. All participants jointly maintain the ledger of financial asset trading. It is ensured that the trading of financial assets is open, transparent, real and credible. The credit risk of trading is reduced. The cross-platform and cross-region flow of financial assets is promoted. Tedious manual account checking work between platforms is omitted. In addition, the block chain technology is applied to the field of financial asset trading for the first time. A unified and standardized financial asset trading platform is established. Digital management of financial assets is realized. The credit risk of trading can be prevented effectively. The efficiency of trading and supervising is improved. The trading cost is reduced.

Owner:HANGZHOU YUNXIANG NETWORK TECH

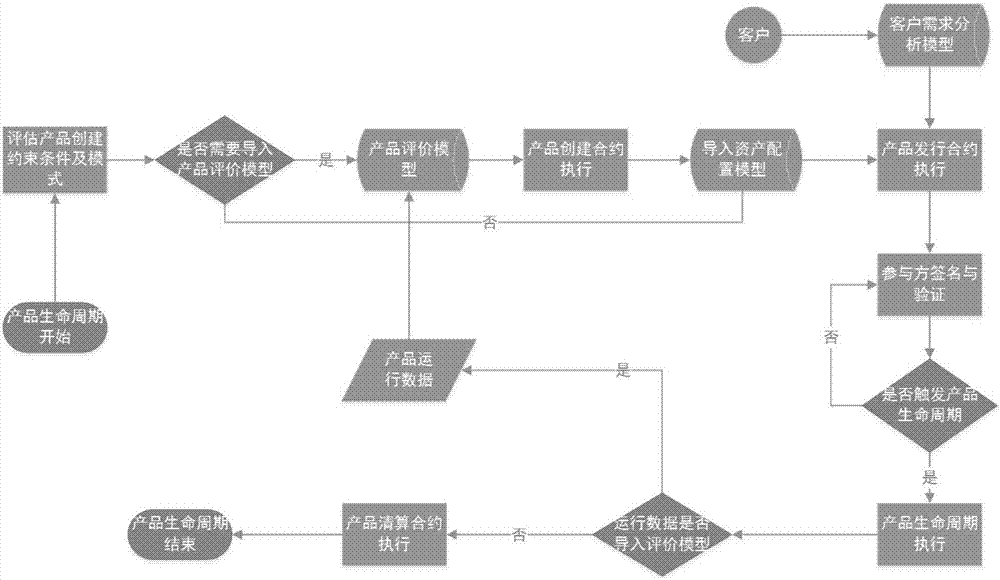

Intelligent investment product collocation method based on block chain intelligent contract technology

InactiveCN107578337AGuarantee authenticityProtection of rights and interestsFinanceRisk ControlTimestamp

The invention discloses an intelligent investment product collocation method based on the block chain intelligent contract technology. According to the method, the authenticity and non tamperability of the data on the chain are guaranteed by block chain consensus, authentication, timestamp and other technical means, and the participants on the chain can see the same and real information; the intelligent contract is automatically executed without artificial interference and supervision in the process of work can be performed to ensure the interests of customers. Being different from the centralized central registration and settlement mechanism, the system of the invention adopts the distributed technical architecture, the participants jointly maintain the product life cycle, thereby ensuring that the products are open and transparent and credible, effectively reducing the credit risk and avoiding the lack of supervision and risk control, resulting from that the product contents and operation means are opaque, and thus the customer rights and interests are not guaranteed.

Owner:HANGZHOU YUNXIANG NETWORK TECH

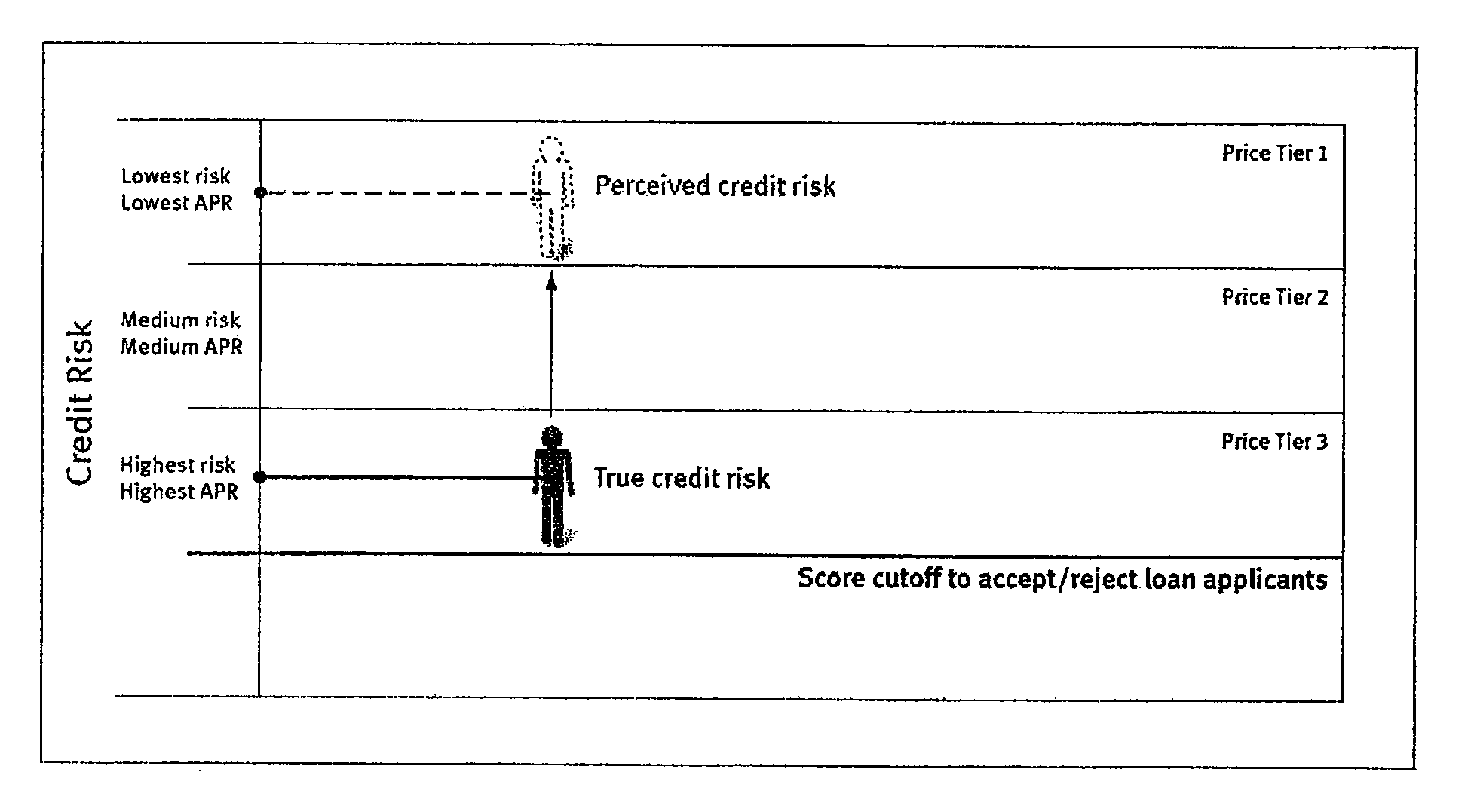

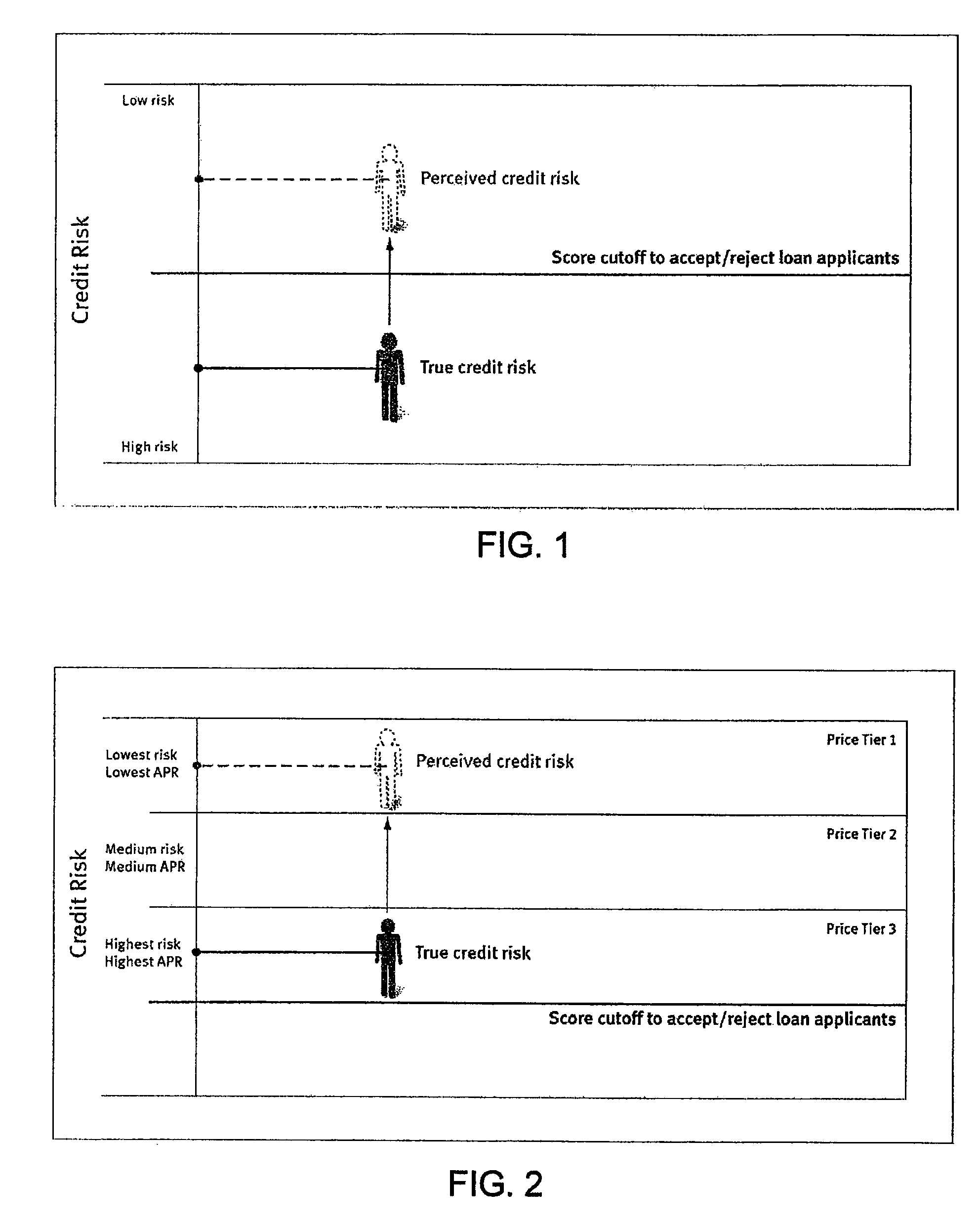

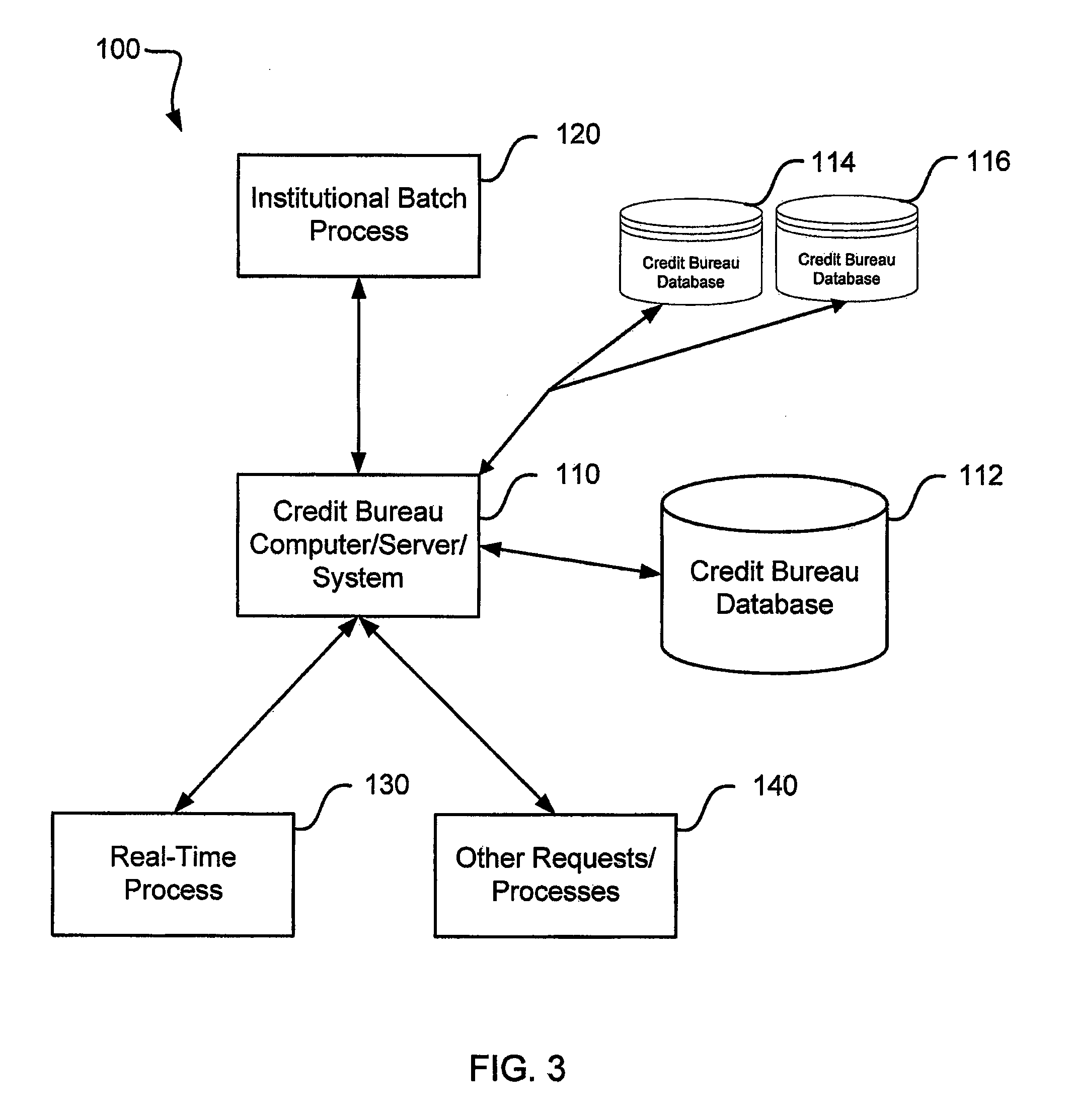

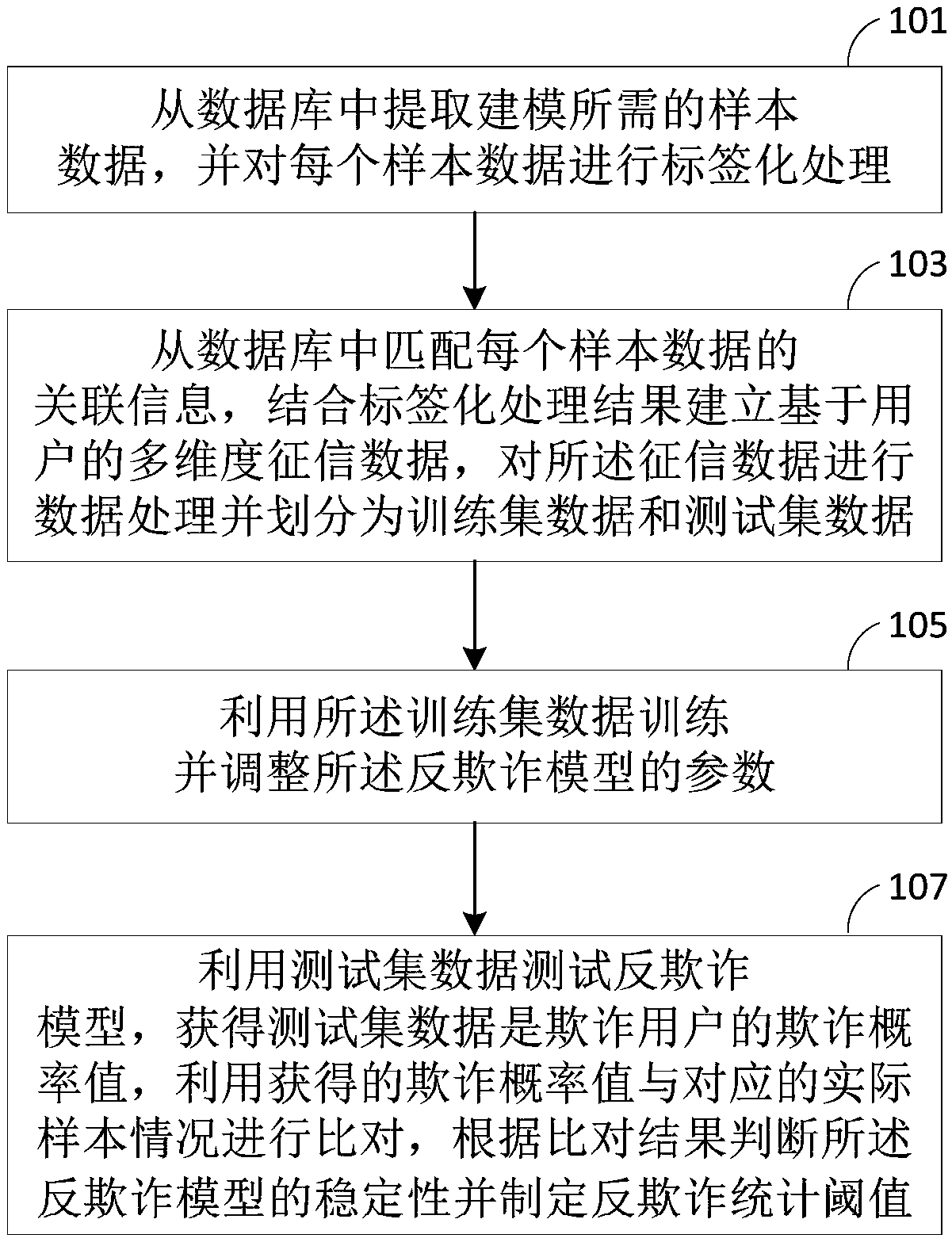

Anti-fraud modeling method and anti-fraud monitoring method based on machine learning

InactiveCN109035003AImprove discrimination abilityReduce credit riskFinanceComputing modelsData processingModelling methods

The invention discloses an anti-fraud modeling modeling method and an anti-fraud monitoring method based on machine learning. The anti-fraud model modeling method based on machine learning comprises the following steps: extracting sample data required for modeling from a database, and carrying out labeling processing on each sample data; matching the association information of each sample data from the database, using the results of labeling processing to establish the multi-dimensional credit data based on the user, and processing and dividing the credit data into training set data and test set data; training and adjusting the parameters of the anti-fraud model by using the training set data; using the test set data to test the anti-fraud model, obtaining the fraud probability value thatthe test set data is fraudulent users. The obtained fraud probability value is compared with the corresponding actual sample situation, and the stability of the anti-fraud model is judged according tothe comparison result, and the anti-fraud statistical threshold value is established. The method can effectively reduce the risk of fraud through label processing and supervised machine learning.

Owner:北京玖富普惠信息技术有限公司

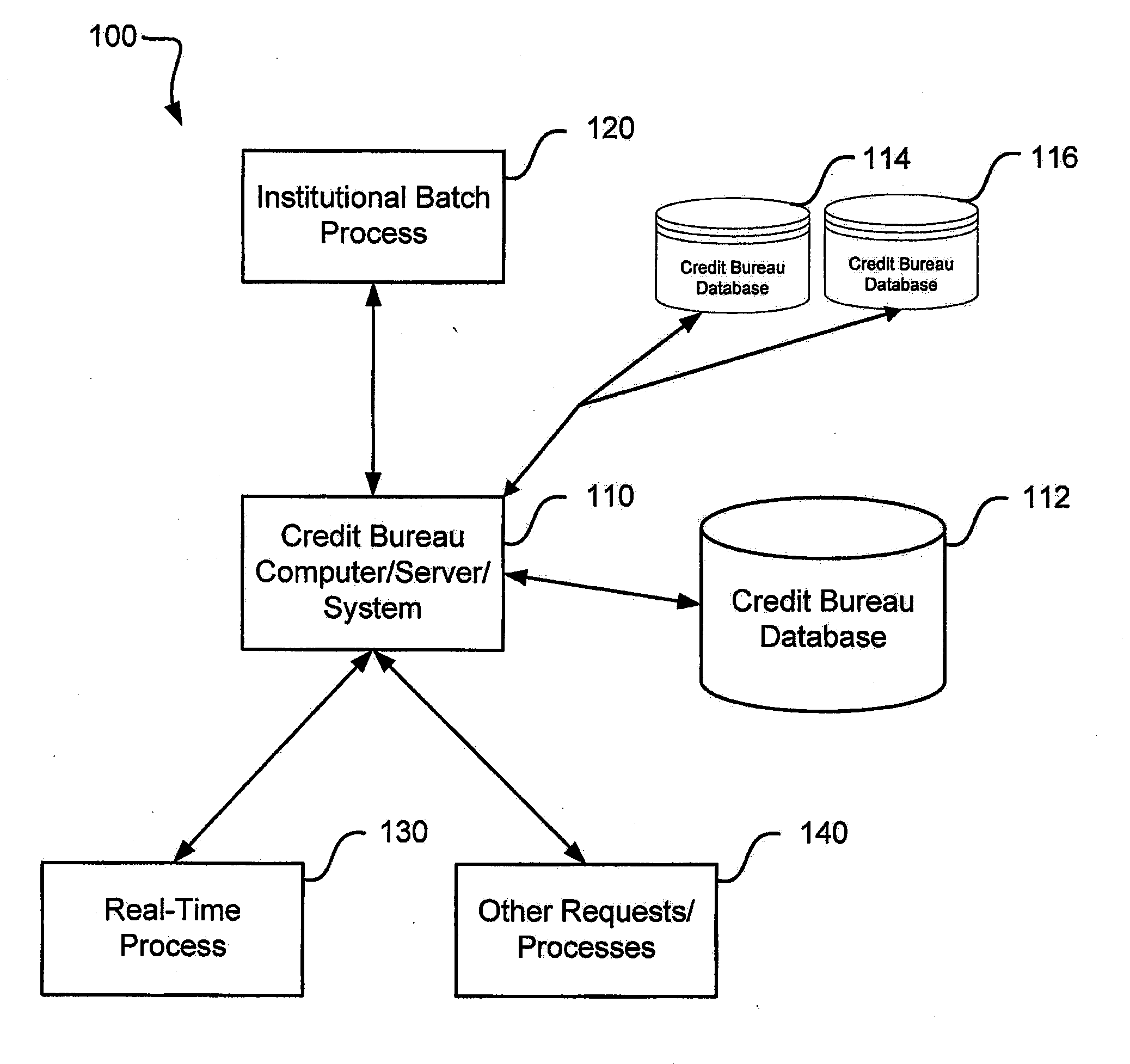

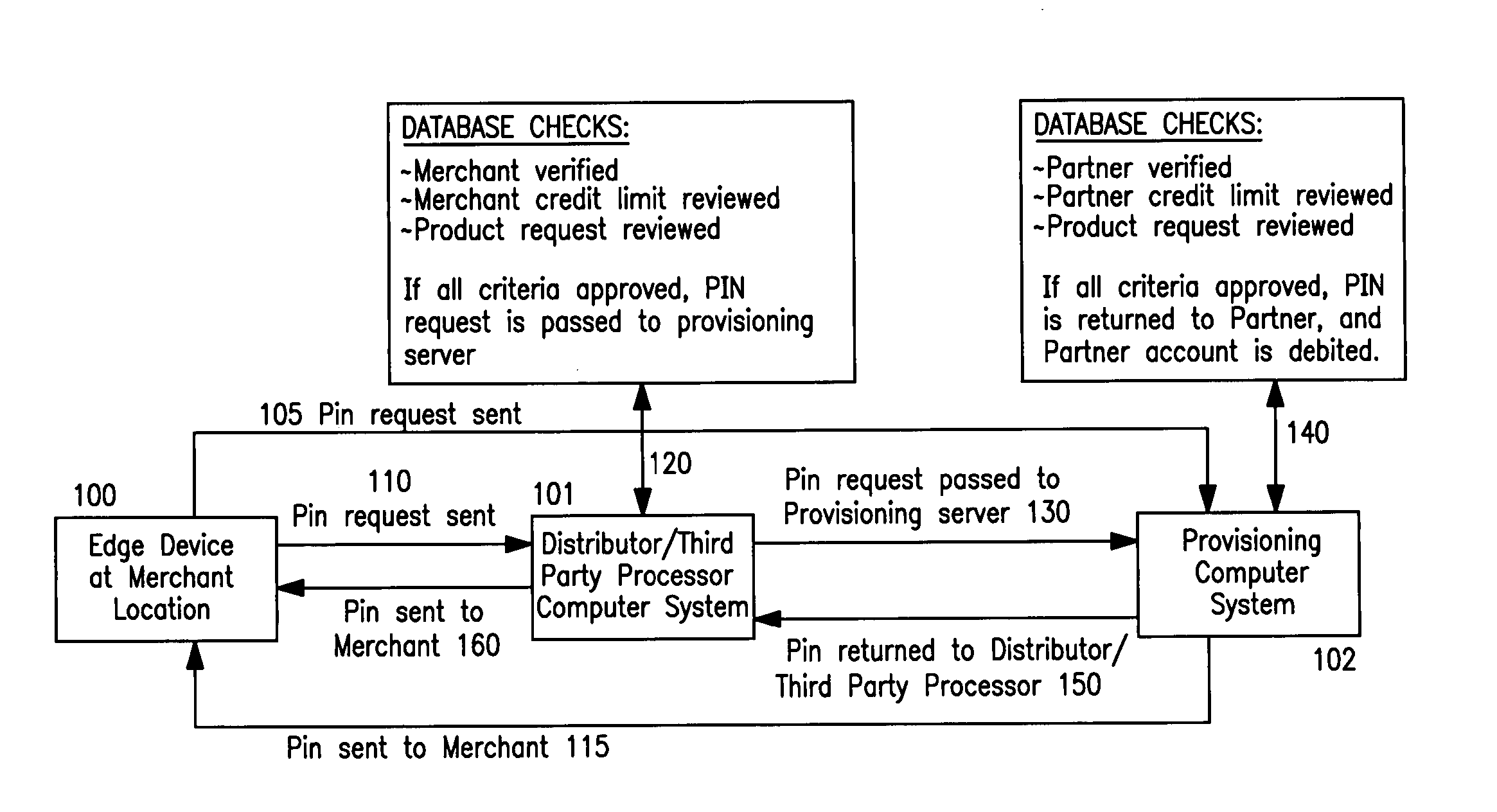

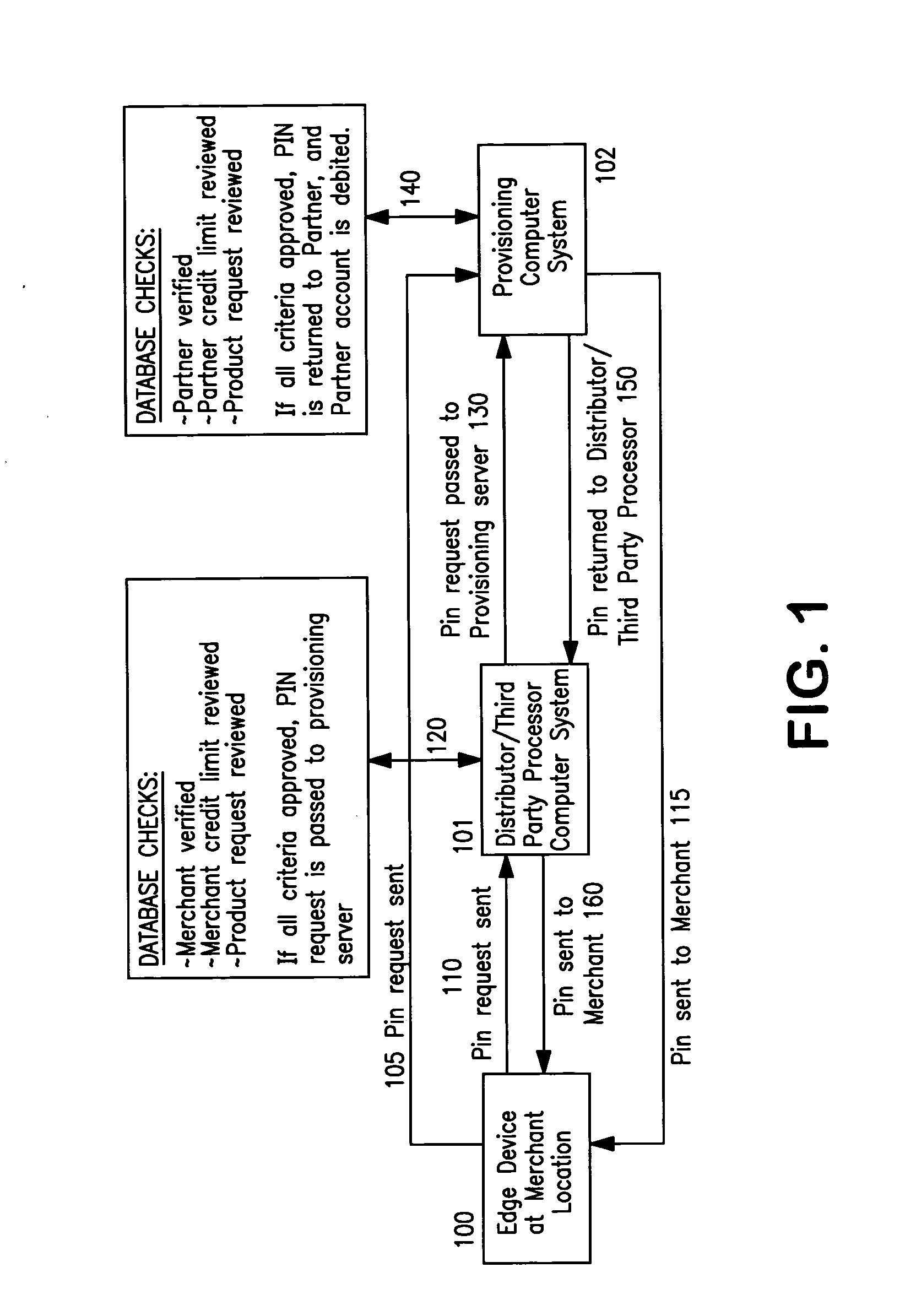

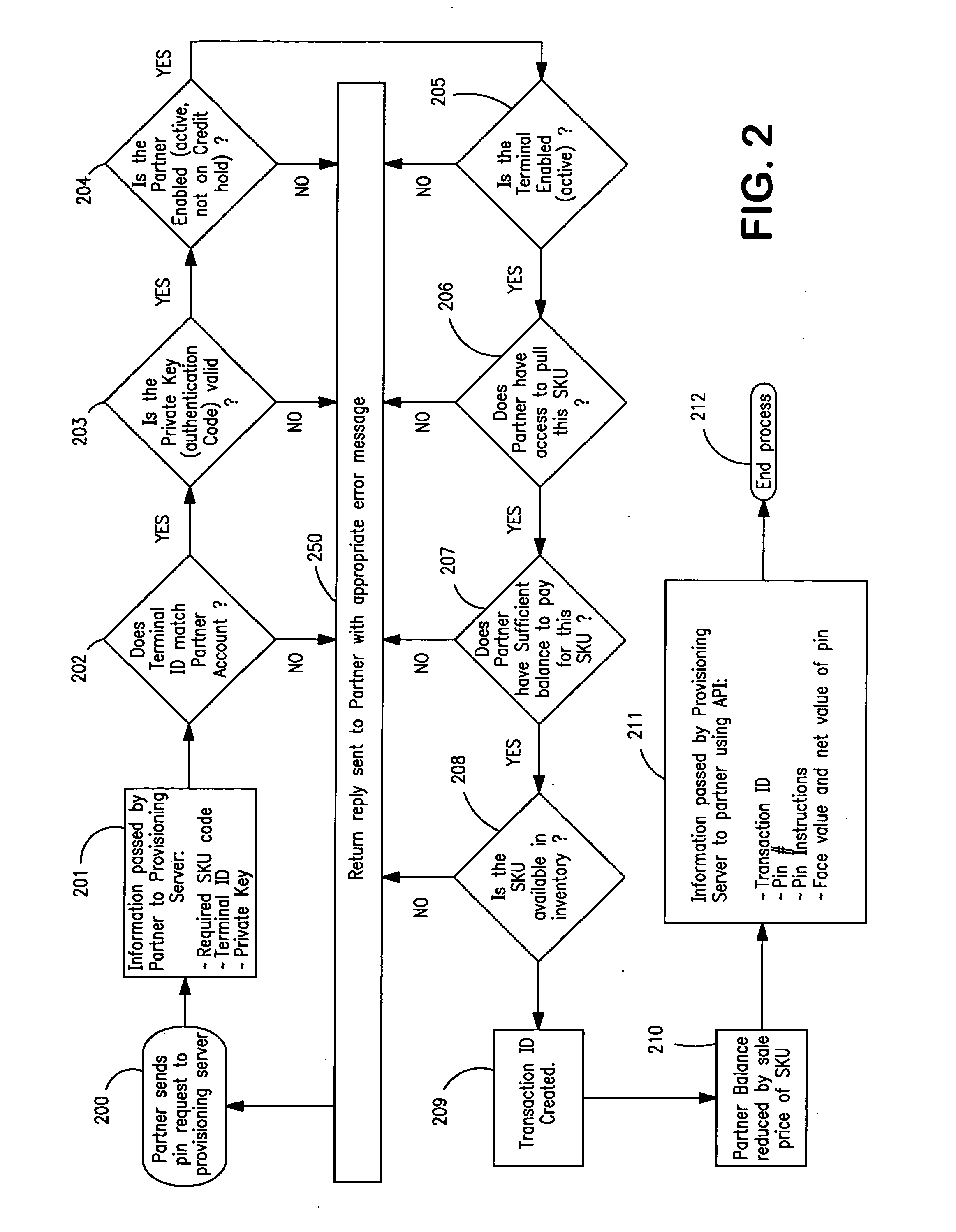

Real-time pin disbursement system

InactiveUS20060074783A1Low costGreat discountFinanceBuying/selling/leasing transactionsThird partyDistributor

An automated system and method of purchasing prepaid and other services against a deposit or a credit threshold. A server provisions requests for electronic PINs. This provisioning server maintains a record for each retail merchant, distributor, or third party processor. Depending on their credit worthiness, the control server either establishes a credit threshold retail merchant, distributor or third party processor or requires a cash deposit. A retail merchant or distributor or a third party processor may obtain an electronic PIN from the provisioning server in real-time or in batches against their credit threshold or deposit.

Owner:VIA ONE TECH

Method and Apparatus for Processing Mobile Payment Using Blockchain Techniques

InactiveUS20180197155A1Reduce in quantityLow costCryptography processingDatabase distribution/replicationApplication serverBank account

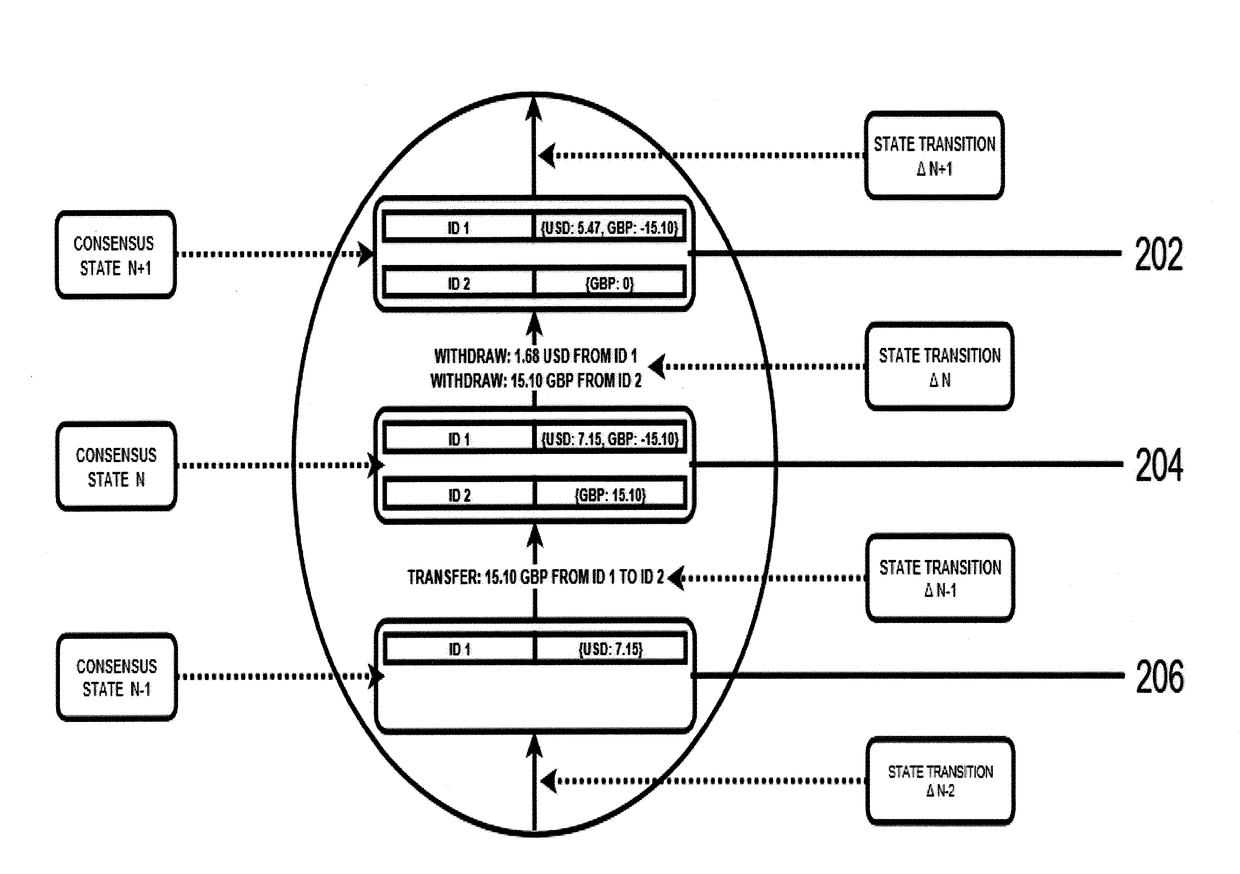

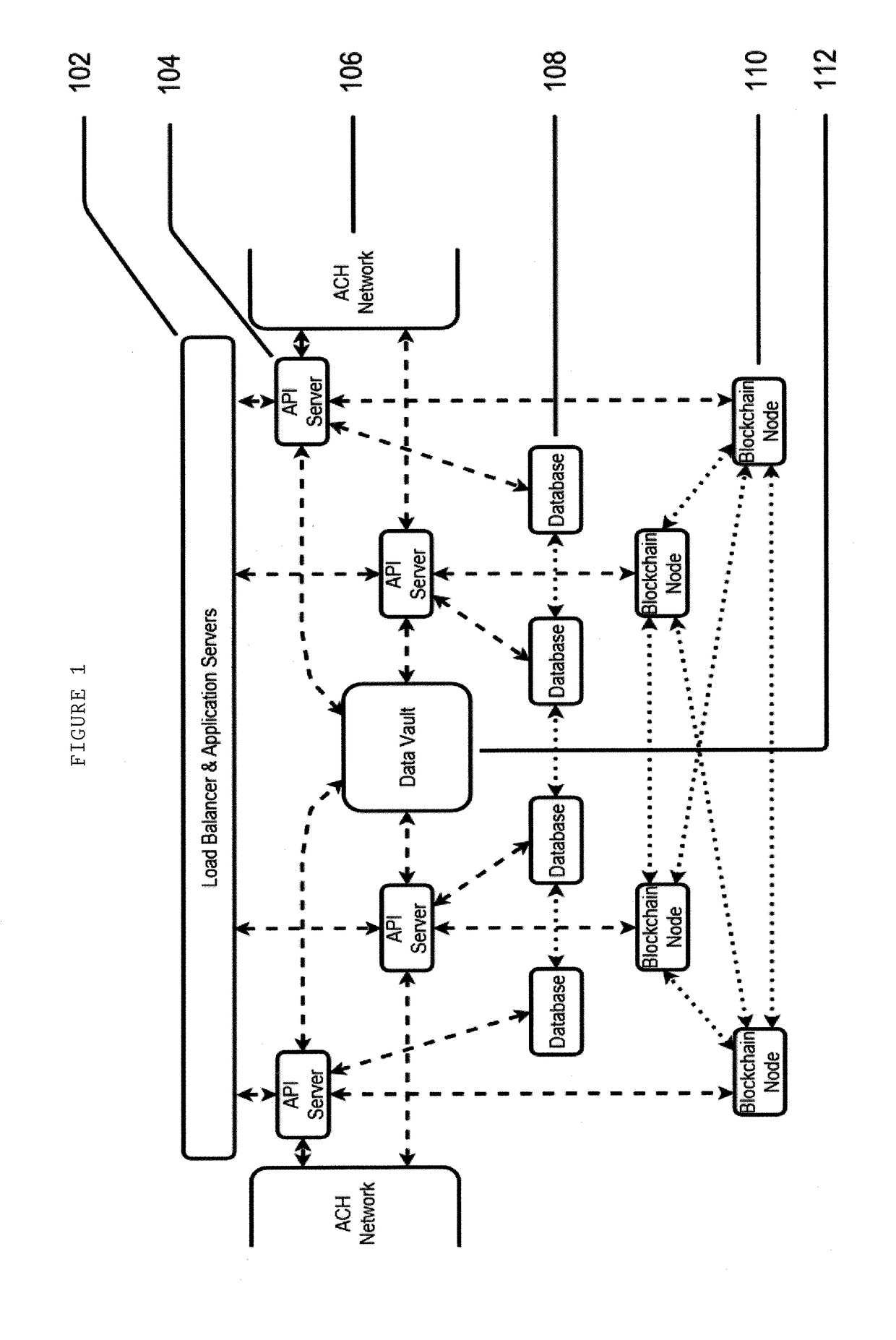

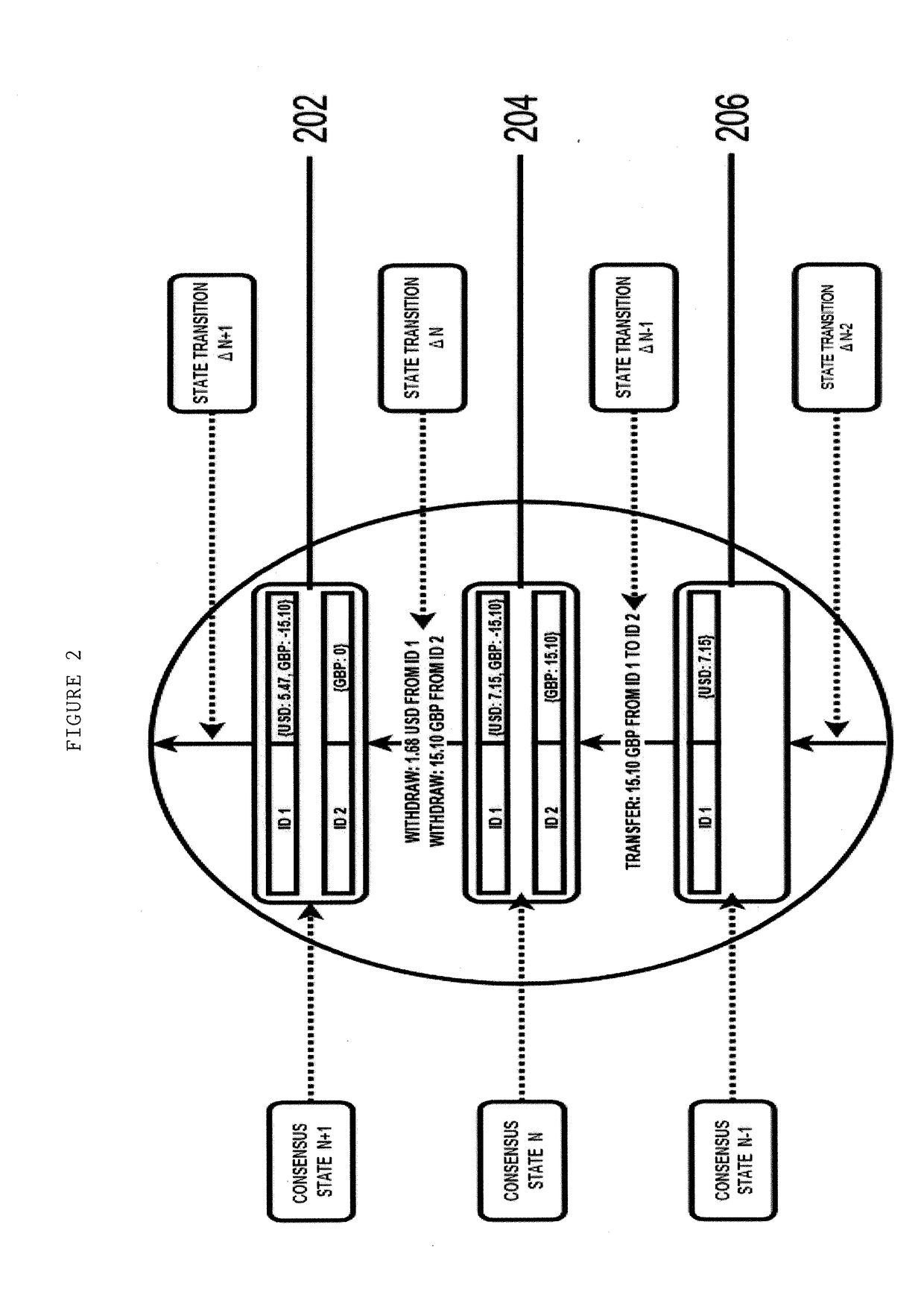

Presently disclosed are devices and method for securely making payments using blockchain and non-blockchain components. The disclosure describes a blockchain layer which includes a transactional ledger for storing transactional information. Additionally, non-blockchain components may interact with the blockchain layer. For example, an application layer may include load balancer and application servers, API servers, a data vault, and a database, and may be used to interface between a user's electronic device and the blockchain layer. Sensitive user information, such as bank account information, social security numbers, etc., are stored in the non-blockchain components (e.g. the data vault) and are used to interface with the blockchain components to facilitate transactions.

Owner:GEORGEN DANIEL

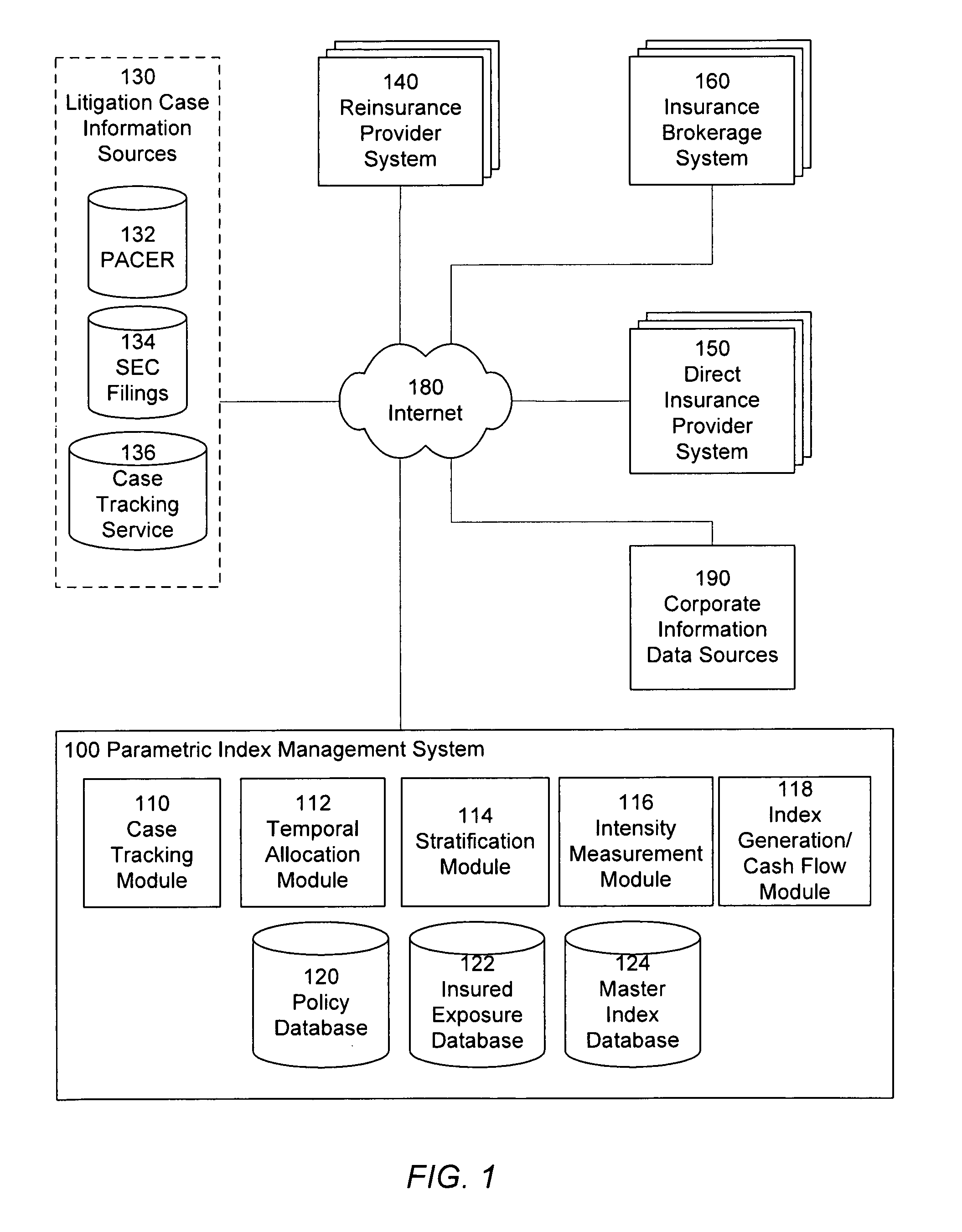

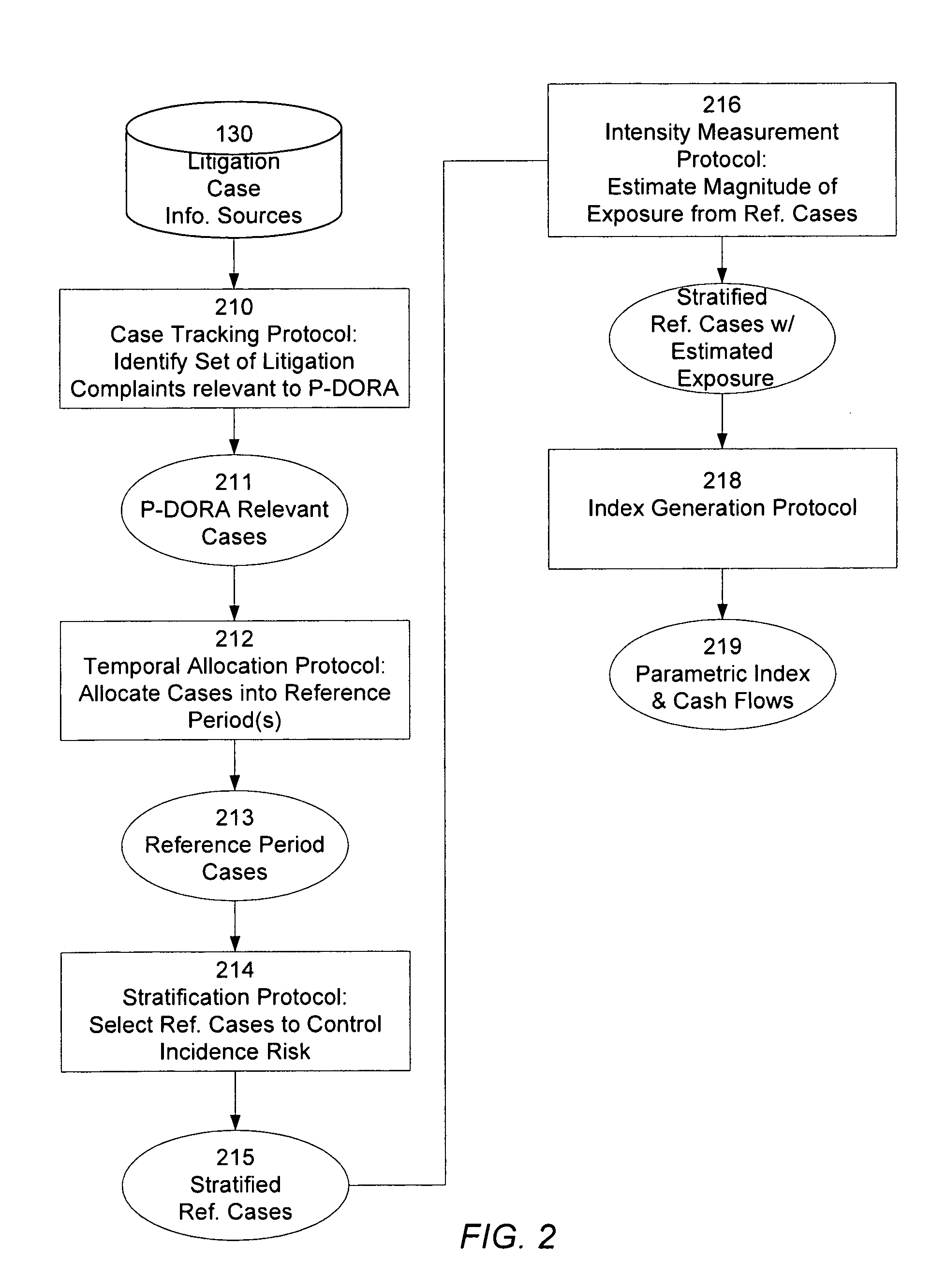

Parametric directors and officers insurance and reinsurance contracts, and related financial instruments

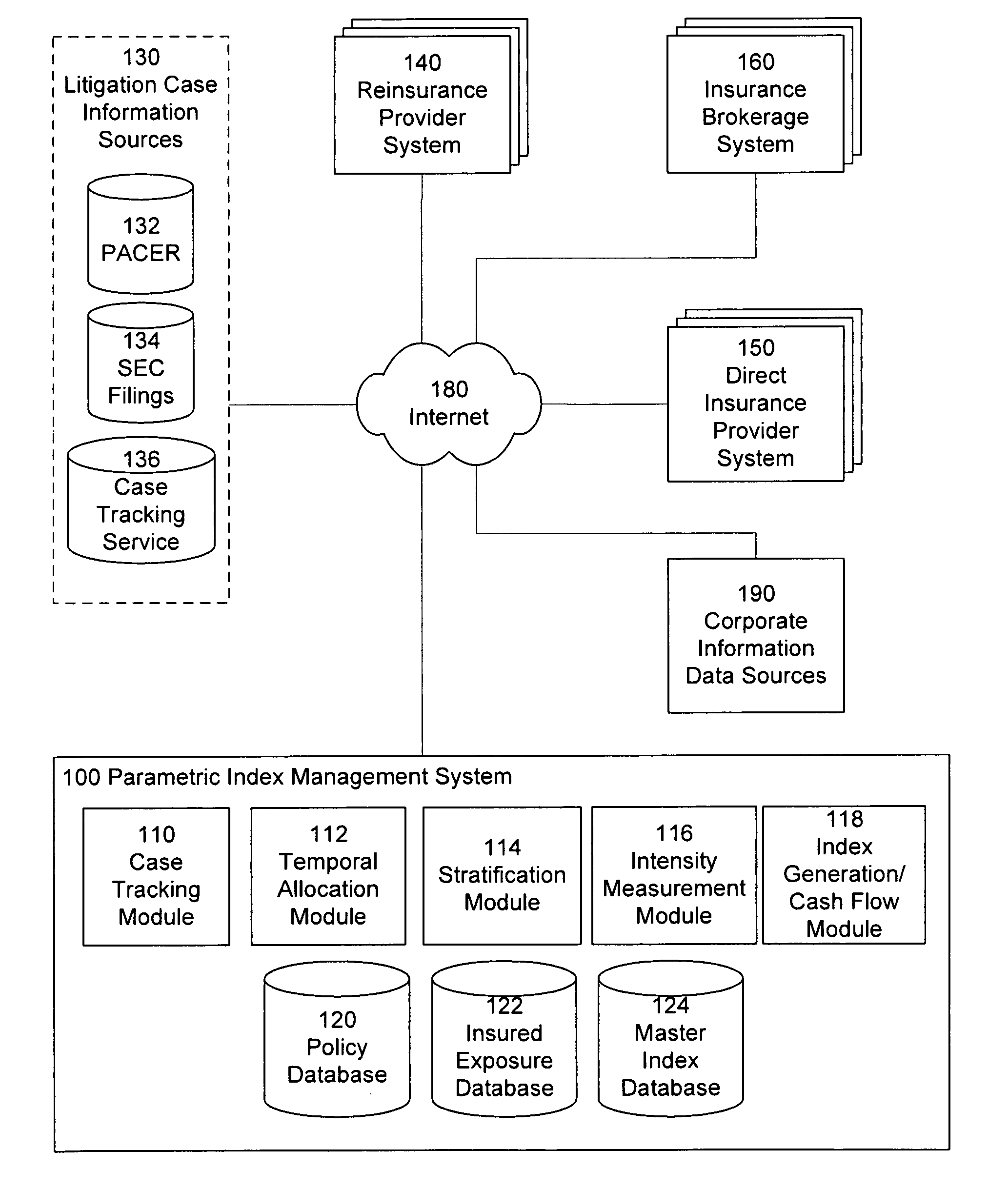

The provision of parametric D&O insurance and reinsurance policies is afforded by systems and methods for determining one or more parametric indices of the risk arising from aggregate litigation activity, which risk is correlated with the financial exposures (e.g., payment cash flows) of the insureds' exposed to such claims, and of the insurers who provide primary D&O insurance coverage. A parametric index is for a given policy is determined from a set of parameters that define the type, scope, timing of litigation activity for the index, as well as details how the index values are determined from the underlying litigation exposure. The system and method further determine whether payments are due under such a policy and their amounts.

Owner:LOWELL WEBSTER

Information storage system

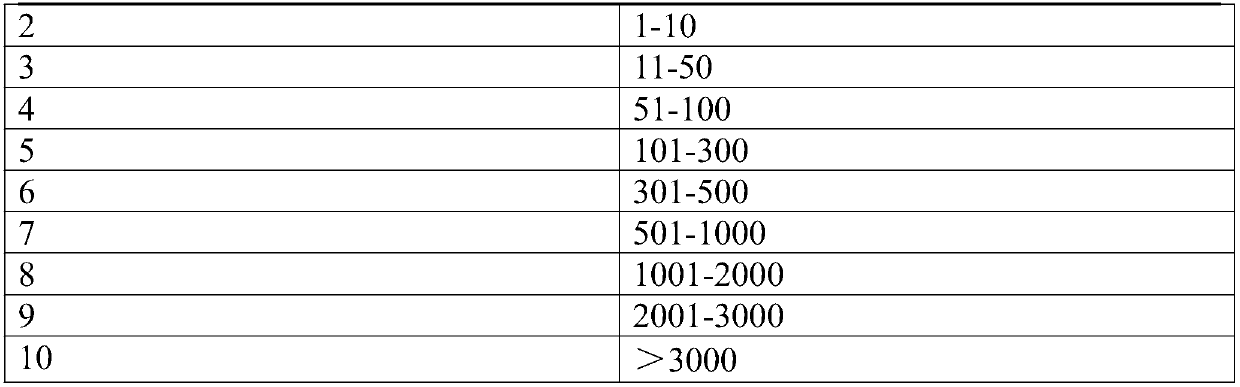

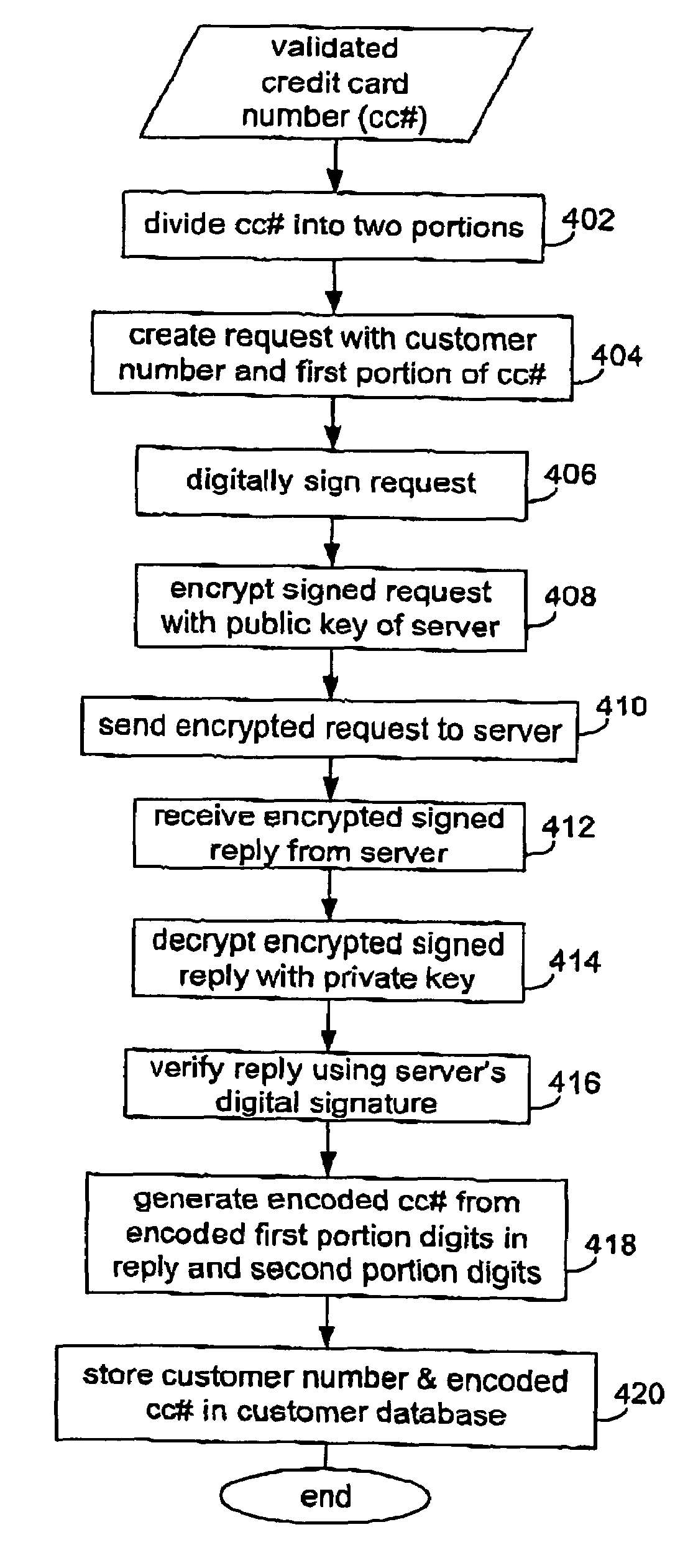

ActiveUS20050188005A1Reduce the risk of theftReduce credit riskUser identity/authority verificationUnauthorized memory use protectionCredit cardClient-side

A system for storing information having a predetermined use which requires the information to be secured. The information may comprise credit card details used to complete a transaction. The system includes: (a) A client system for storing an encoded version of the information and an identifier. The encoded version is generated from first data of the information and an encoded version of the second data of the information. The information can be generated from the first data and the second data, and the predetermined use is infeasible with only one of the first data and the second data, (b) A remote server for storing the second data and an encoded identifier generated from the identifier. The client system sends at least the encoded version of the second data to the remote server. The client system or the remote server is able to generate the information from the first data and the second data. Accordingly, only part of the information to be secured is stored locally on the client system, whilst the other part is stored on the remote server, and neither the client system nor the remote server have a record of the entire information.

Owner:ENDRESZ ALLAN

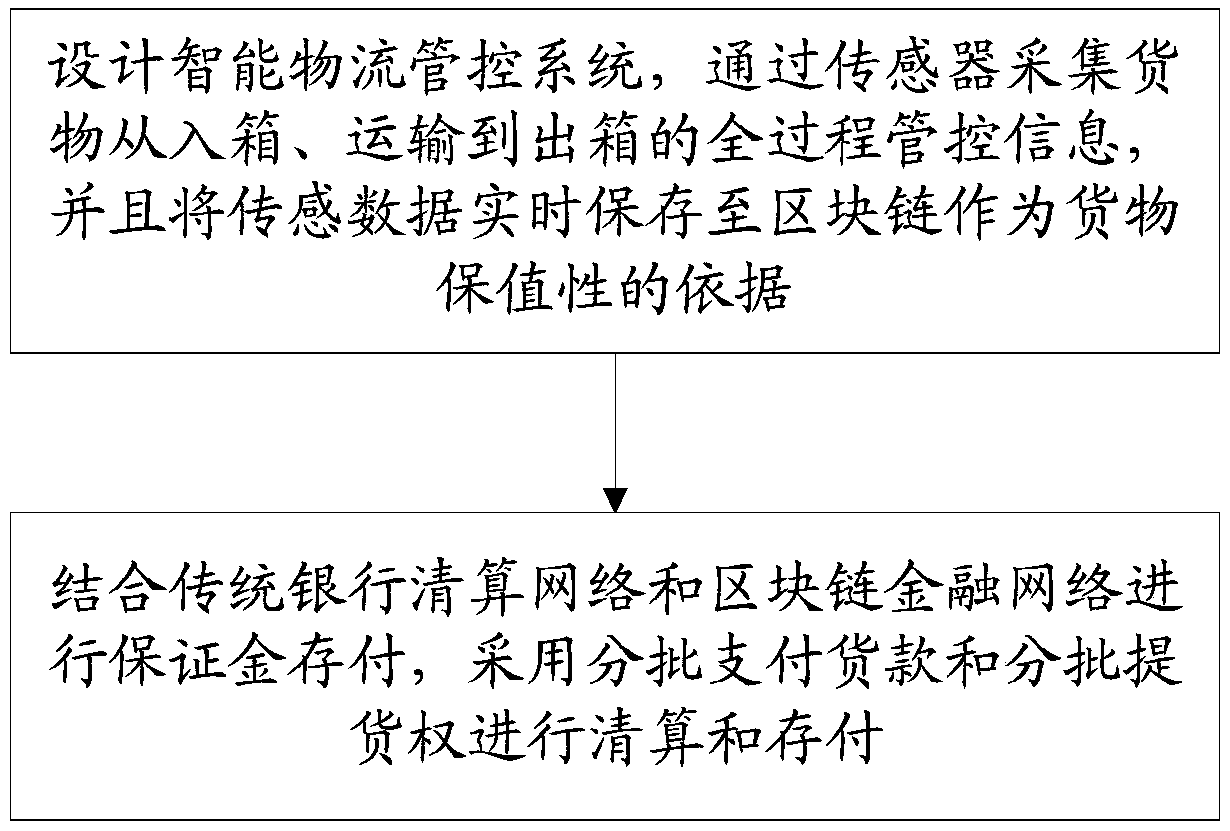

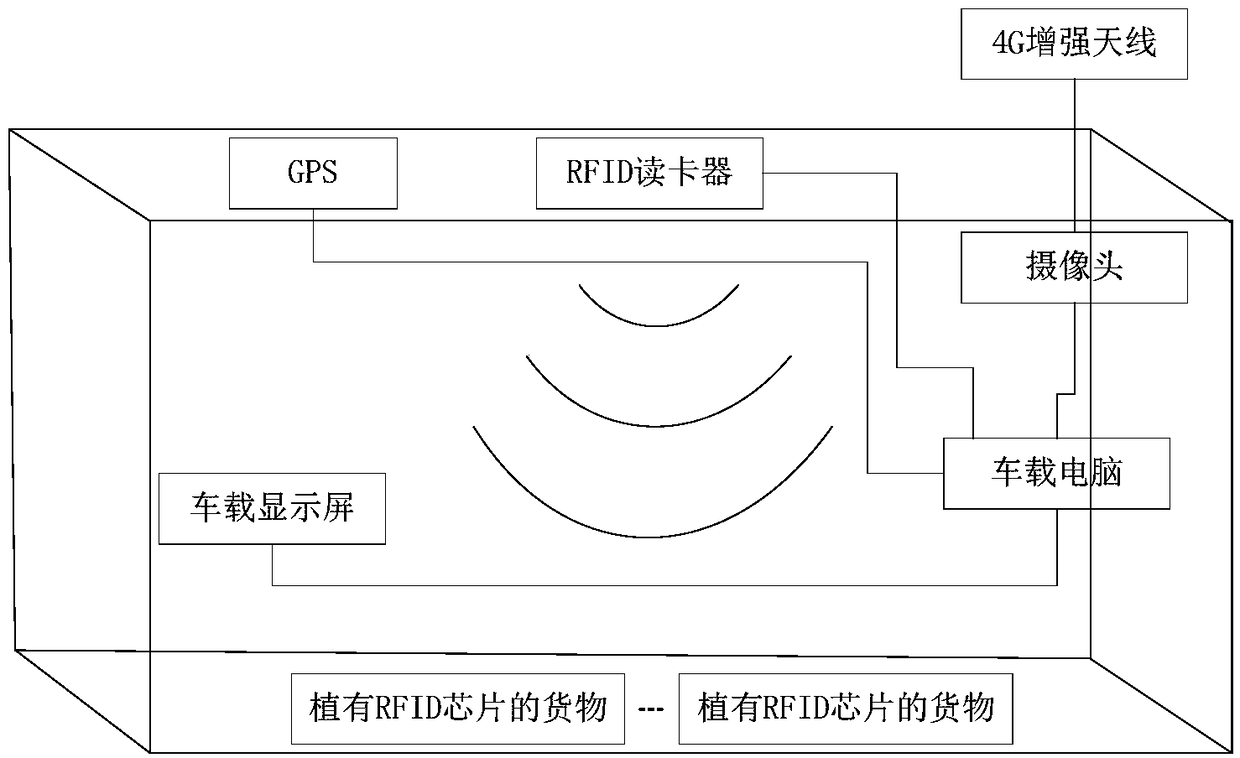

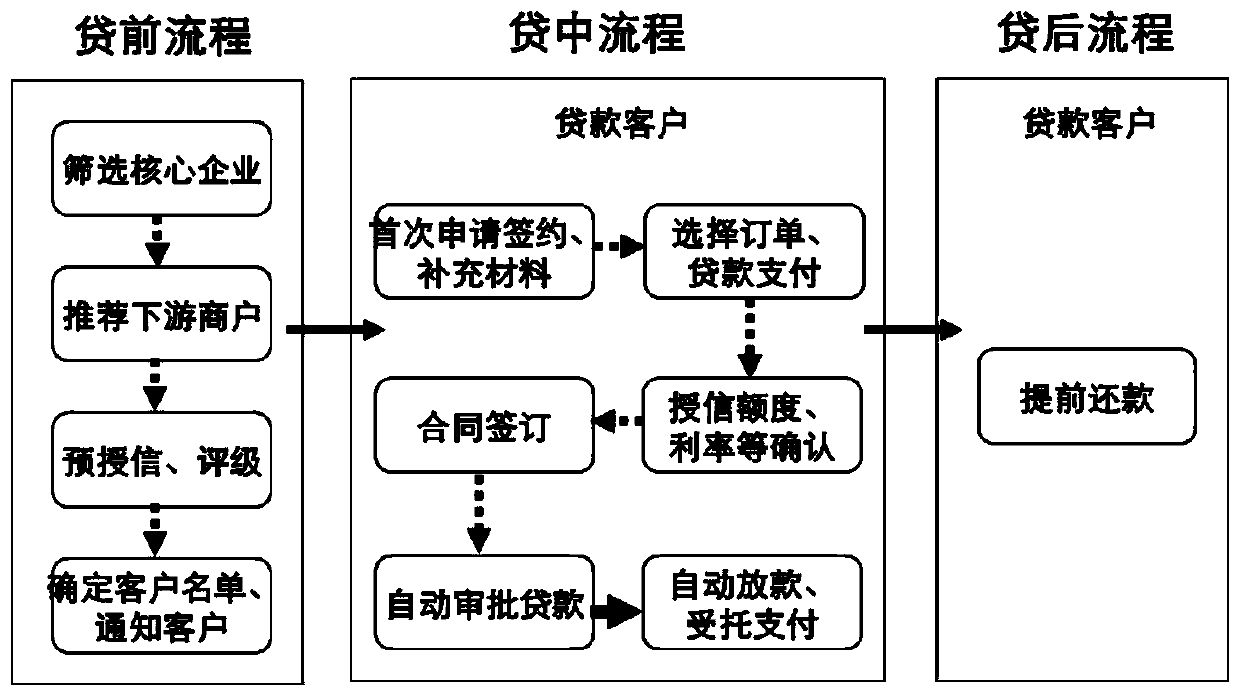

Supply chain prepayment financing method based on block chain of internet of things

PendingCN108694551AResolve trust issuesRealize the payment problemFinanceLogisticsPaymentSensing data

The invention provides a supply chain prepayment financing method based on a block chain of the internet of things. The method comprises the following steps: designing an intelligent logistics management and control system, acquiring the whole process management and control information of goods from container loading, transportation to container unloading by a sensor, and saving the sensing data to the block chain in real time as the basis of goods value preservation; and by combining with the traditional bank clearing network and block chain financial network to deposit and pay deposits, performing clearing and depositing and paying by using batch payment of the price for goods and batch right of taking delivery of goods. The invention designs a supply chain prepayment financing method based on the internet of things and the block chain technology, the issue of trust among multi-agency bodies has been effectively resolved, the invention realizes the payment problem of purchasing and selling goods and four-party silver under the heterogeneous network, the method is suitable for the safe transportation of goods of various enterprises, realizes the real-time collection and trustworthy saving of data in the transmission process, guarantees the value preservation of the goods transportation, reduces the risks of the bank, and effectively alleviates the short-term capital pressure brought by the full-amount purchase, and realizes the multi-win purpose.

Owner:FUJIAN RURAL CREDIT UNION

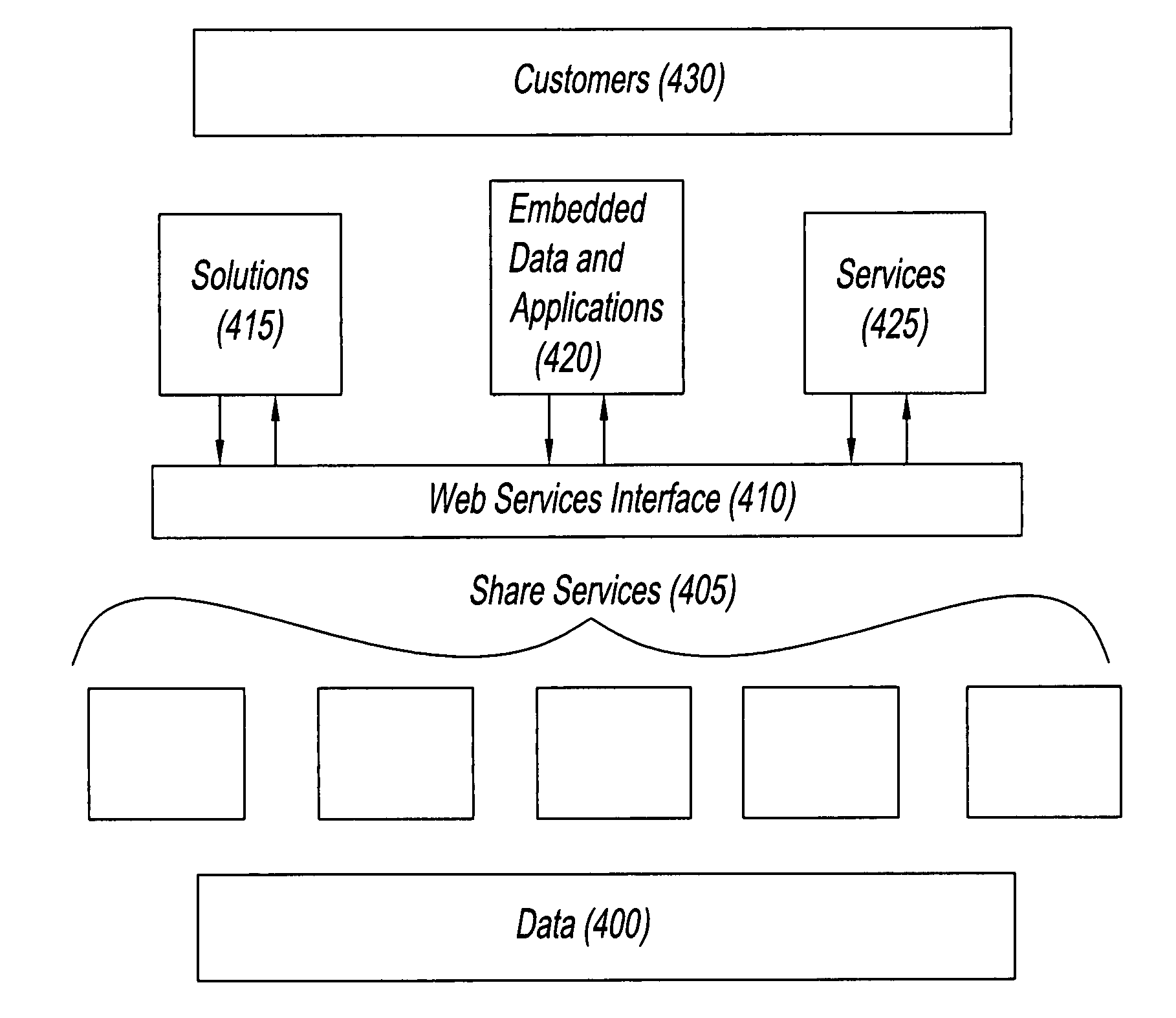

Modular web-based ASP application for multiple products

ActiveUS7708196B2Efficiently decideEasy to analyzeFinanceOffice automationModularityApplication software

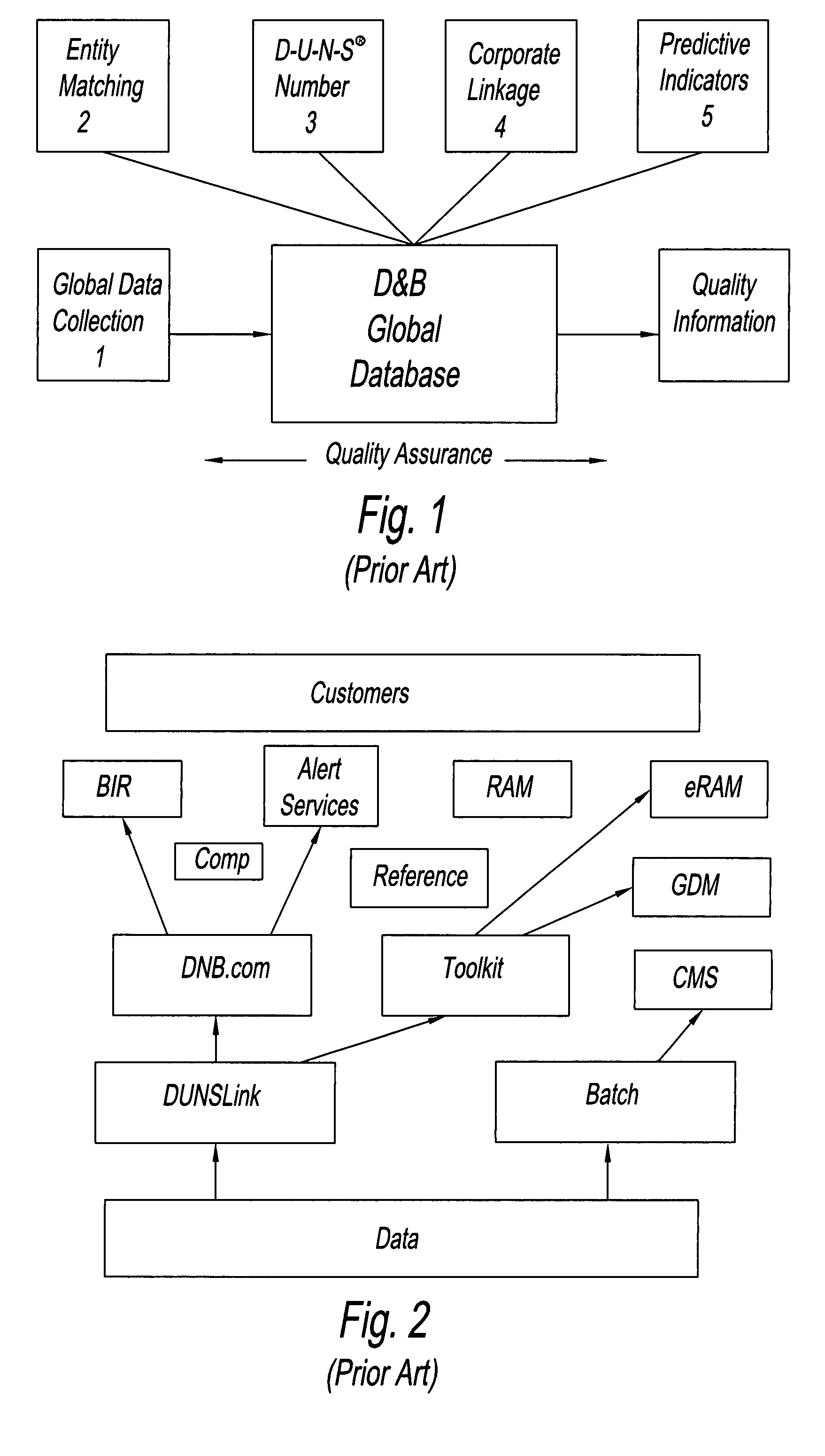

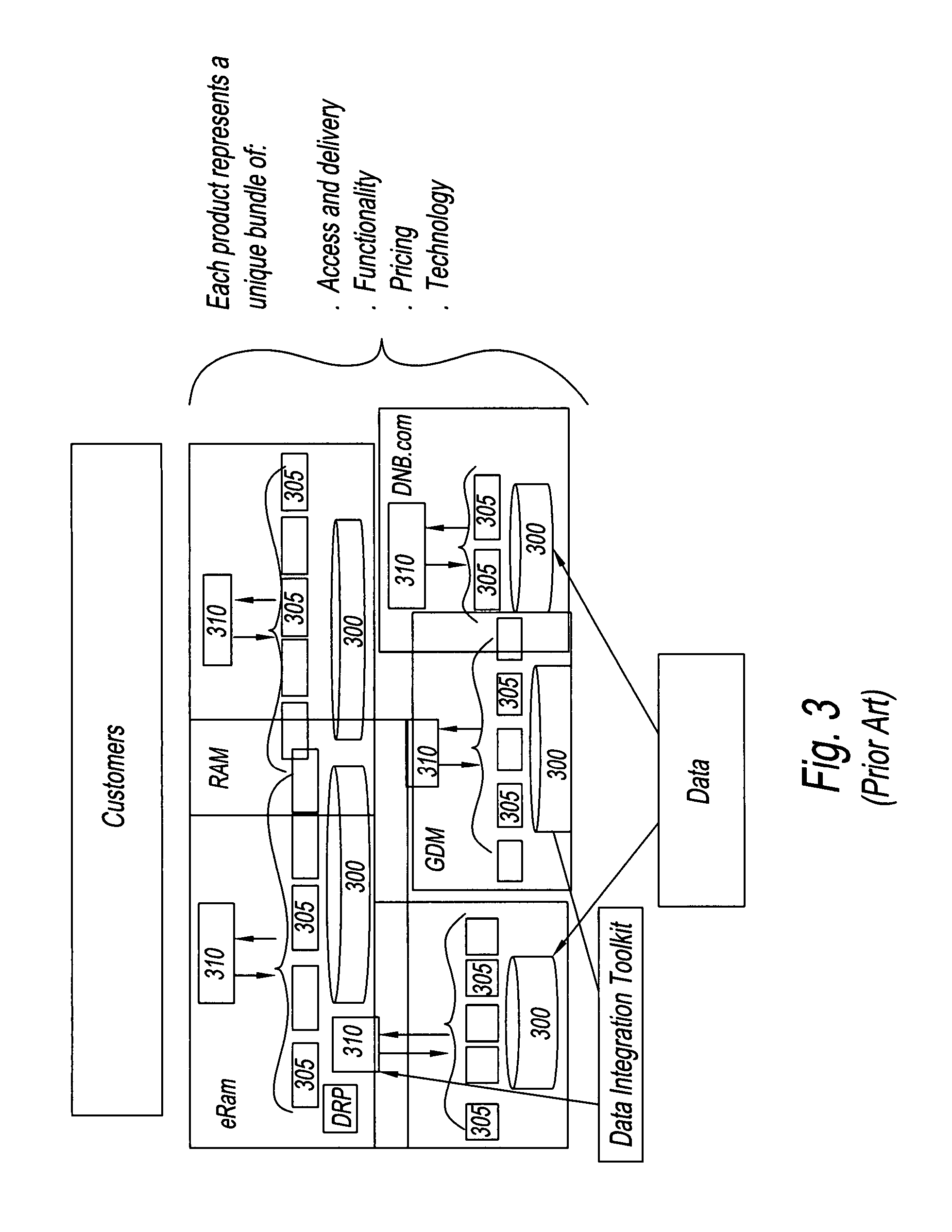

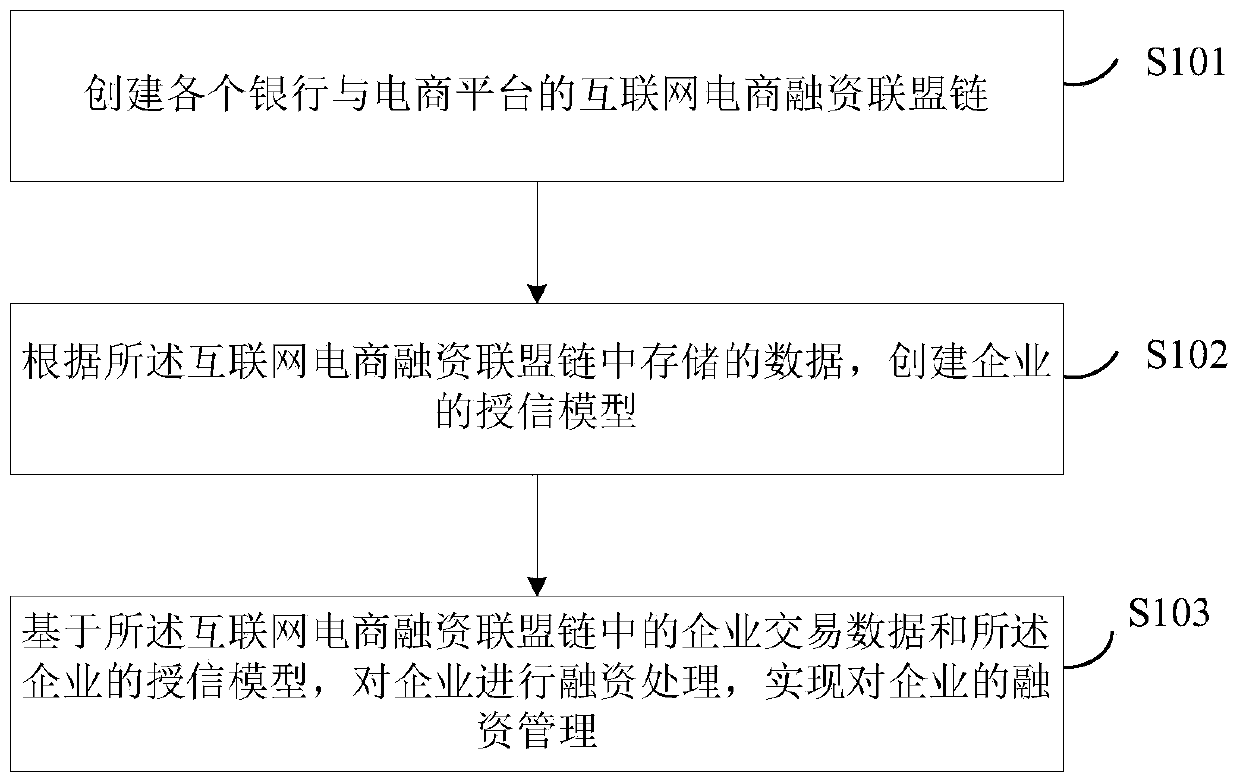

A method of providing business information data to a user, including allowing the user unlimited access to interactive, customizable modular applications through a single platform. The applications interface with a database to provide real-time business information data to the user, the business information data relating to an entity and being based on a unique corporate identification number associated with the entity.

Owner:THE DUN & BRADSTREET CORPORATION

Internet e-commerce financing management method and system based on a block chain

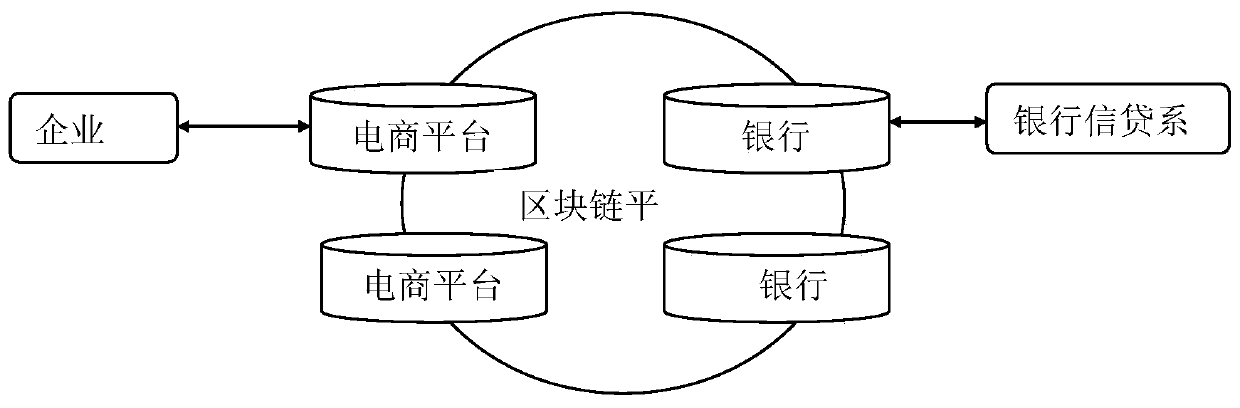

InactiveCN109801159ANot easy to tamper withSolve multi-party trust issuesFinanceResourcesThe InternetTransaction data

The invention discloses an internet e-commerce financing management method and system based on a block chain, and the method comprises the steps: building an internet e-commerce financing alliance chain of each bank and an e-commerce platform, and enabling the internet e-commerce financing alliance chain to store enterprise transaction data and credit data; According to the data stored in the internet e-commerce financing alliance chain, creating a credit model of the enterprise; And based on the enterprise transaction data in the Internet e-commerce financing alliance chain and the credit model of the enterprise, financing the enterprise to realize financing management of the enterprise. According to the invention, the multi-party trust problem in a supply chain financial scene is solved,and the credit risk is effectively reduced.

Owner:AGRICULTURAL BANK OF CHINA

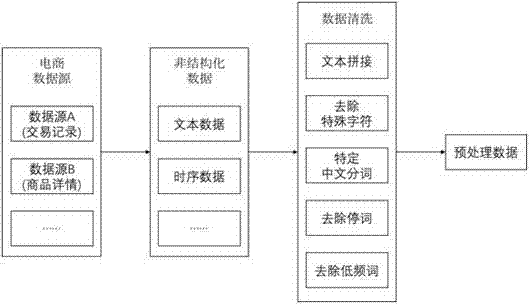

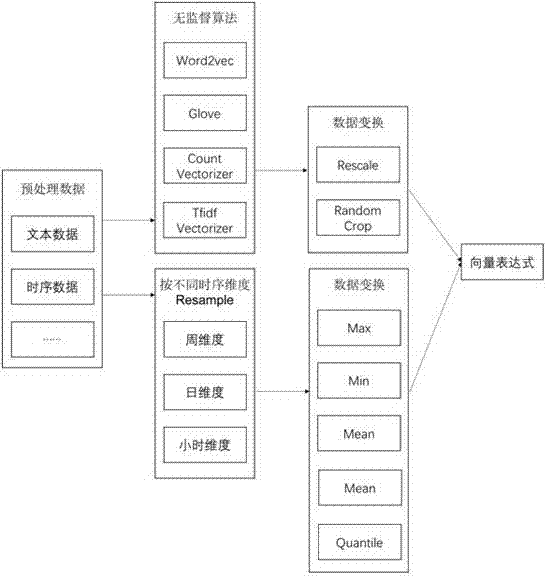

Unstructured data default probability prediction method based on deep learning

ActiveCN107992982AThe solution cannot be efficientlySolve usabilityFinanceForecastingRisk ControlUnstructured data

The invention relates to an unstructured data default probability prediction method based on deep learning. The method comprises the steps as follows: unstructured data, including text data and time series data, of credit subjects are integrated and cleaned; the unstructured data are converted into a data format recognizable by a deep learning model; data features are extracted as sample data on the basis of a deep learning model frame; as for the extracted sample data, a credit risk model is constructed by use of a complex machine learning classification algorithm-integrated tree model, and default probability prediction is output. According to the method, the unstructured data such as text and time sequence data are mined, potential risk behavior modes of the credit subjects are caught on the basis of deep learning and a big data technology, high dimensional data credit risk modeling is performed accordingly, automatic, comprehensive and procedural quantitative credit risk analysis for the credit subjects is realized, the finance risk control capacity is improved, and the credit risk is reduced.

Owner:上海氪信信息技术有限公司

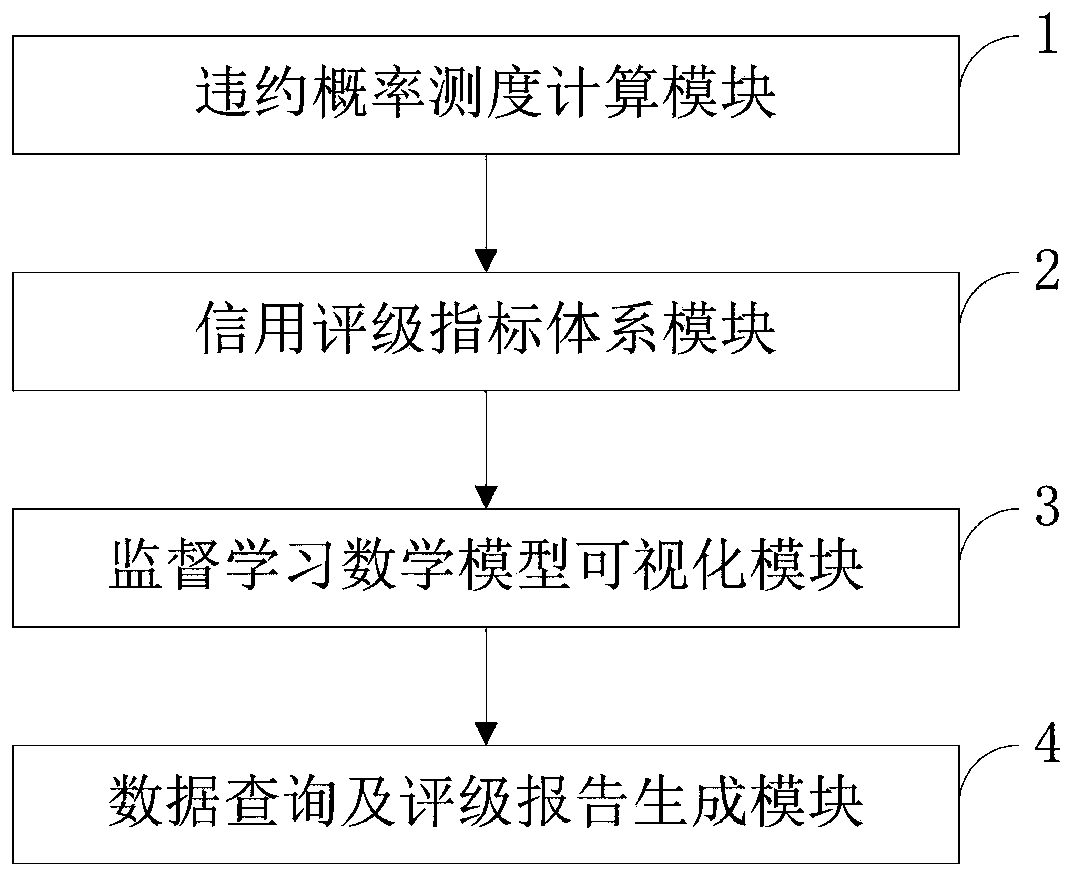

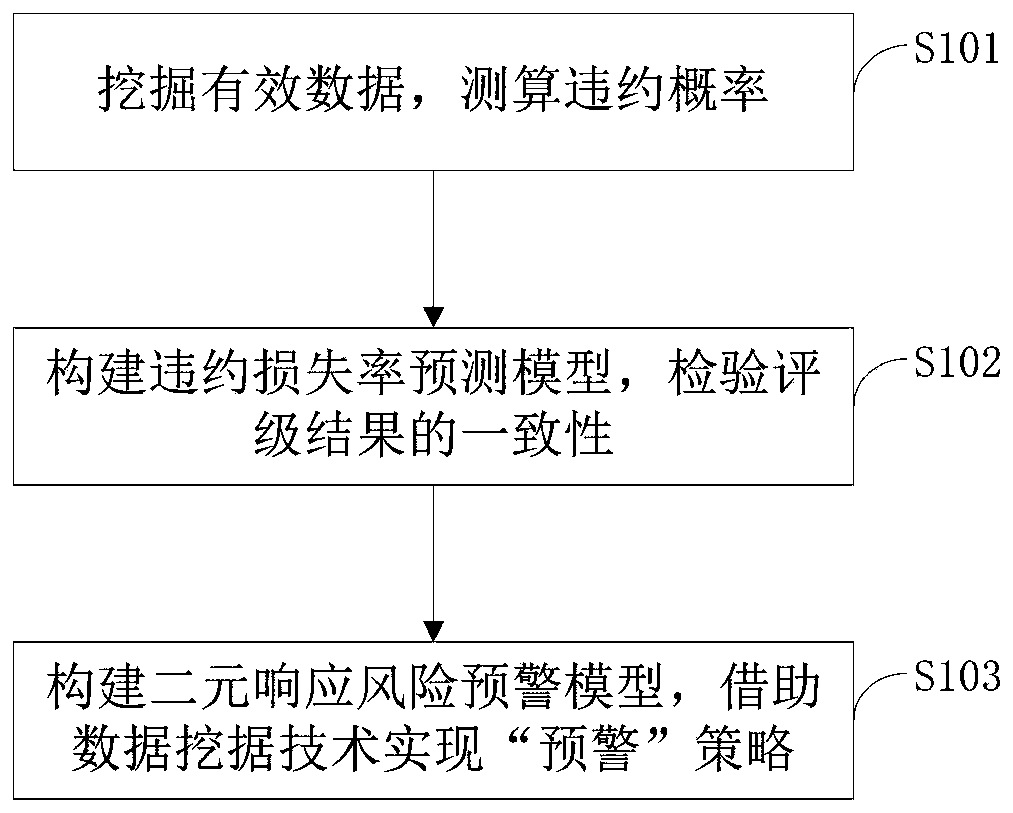

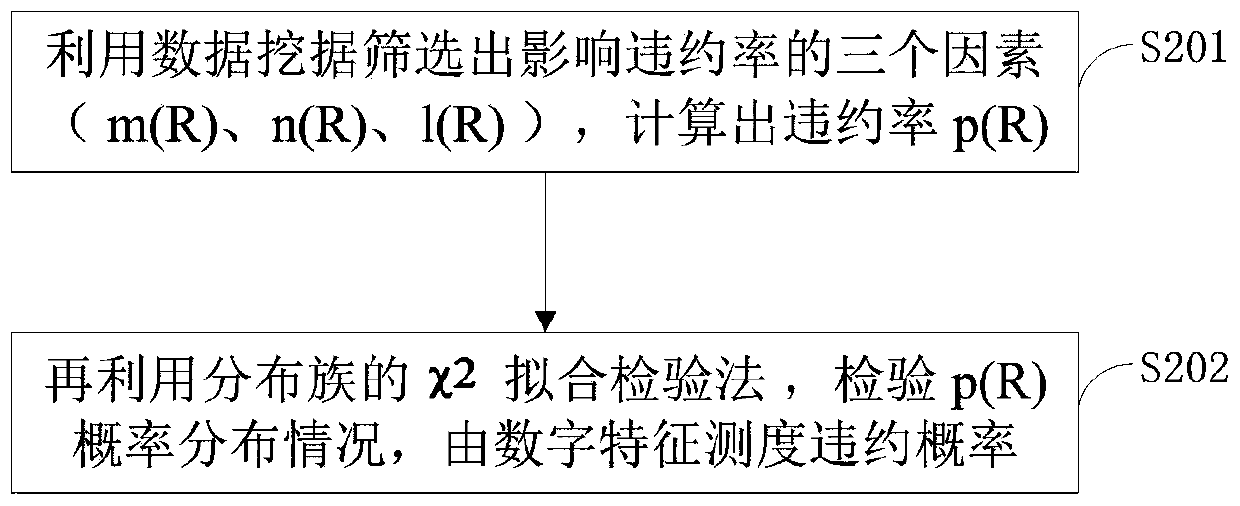

Credit rating default probability measurement and risk early warning method

ActiveCN110110981AReduce credit riskReduce exposureFinanceCharacter and pattern recognitionEarly warning systemLoss rate

The invention belongs to the technical field of financial information data management, and discloses a credit rating default probability measure and risk early warning method. The method comprises thefollowing steps: mining valid data and measuring and calculating default probability; constructing a default loss rate prediction model, and checking the consistency of rating results; and constructing a binary response risk early warning model, and realizing an early warning strategy by means of a data mining technology. Through research and application of a credit rating mathematical model, a set of credit rating system which can be verified by using data and is high in feasibility is finally formed by using a data mining technology, and effective practical experience is obtained. Meanwhile, the research result can cooperate with the financial industry and can also cooperate with credit enterprises to provide credit products and technical services for the enterprises and provide data reference for transaction decisions of market subjects, so that contribution is made to credit demands and credit industry development.

Owner:CHONGQING UNIV OF EDUCATION

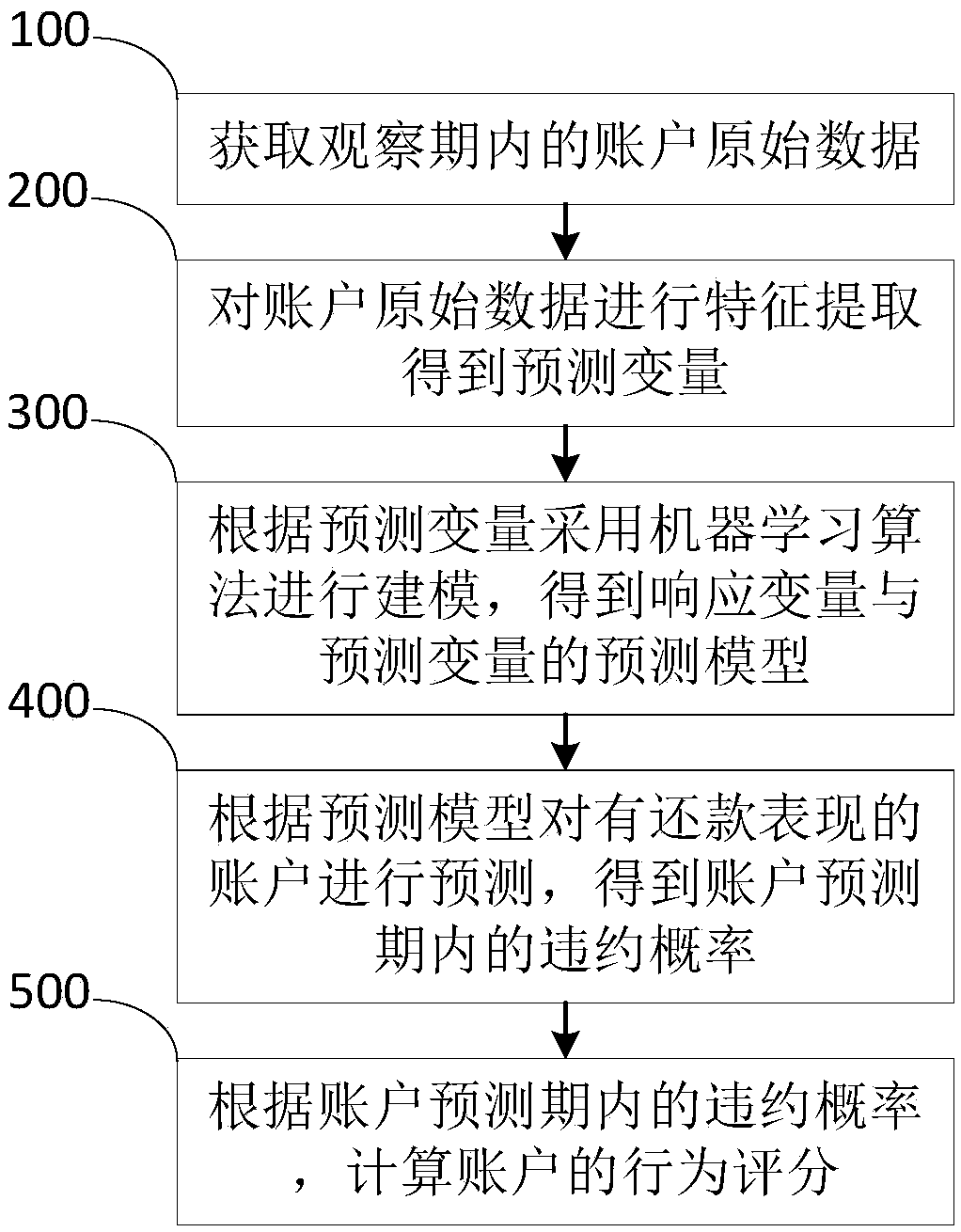

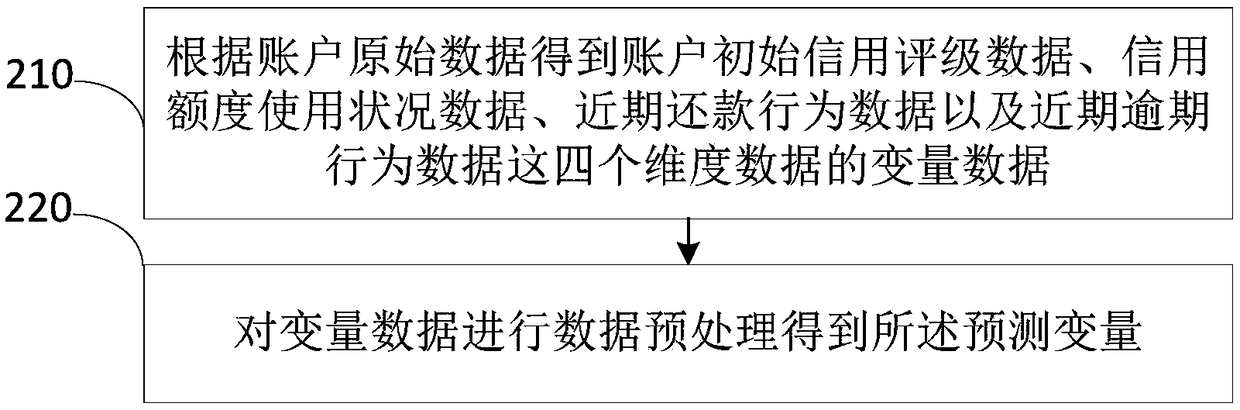

Credit monitoring and scoring method and system based on a behavior model

InactiveCN109191282AIncreased speed of changeAcquisition speed is fastFinanceFeature extractionOriginal data

The invention discloses a credit monitoring and scoring method and system based on a behavior model. The method comprises the following steps: obtaining the original data of an account in an observation period; carrying out feature extraction on the original data of the account to obtain a prediction variable; according to the prediction variables, using the machine learning algorithm for modeling, and obtaining the prediction model of the response variables and the prediction variables; predicting an account with repayment performance according to the predicting model to obtain a default probability in the predicting period of the account; calculating the behavior score of the account according to the default probability of the account during the prediction period. The invention can increase the data changing speed, improve the applicability and generalization, and carry out accurate behavior scoring on the account.

Owner:北京玖富普惠信息技术有限公司

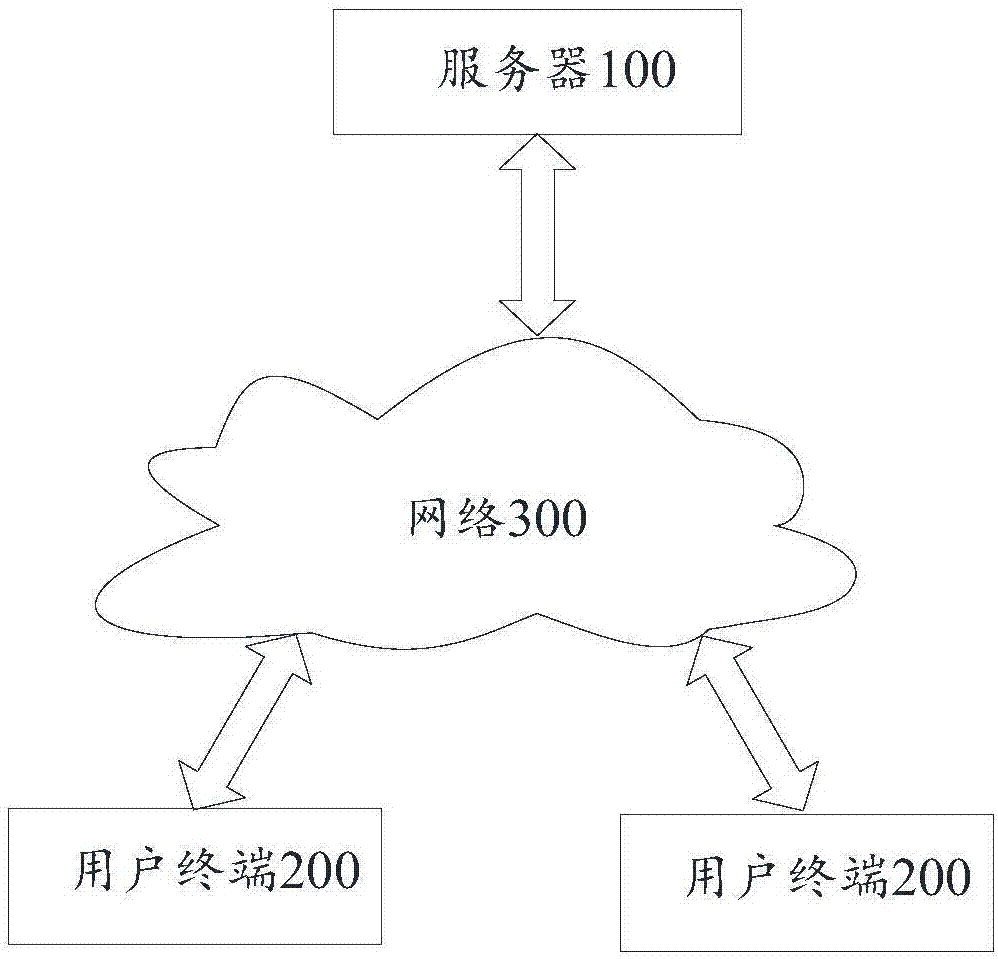

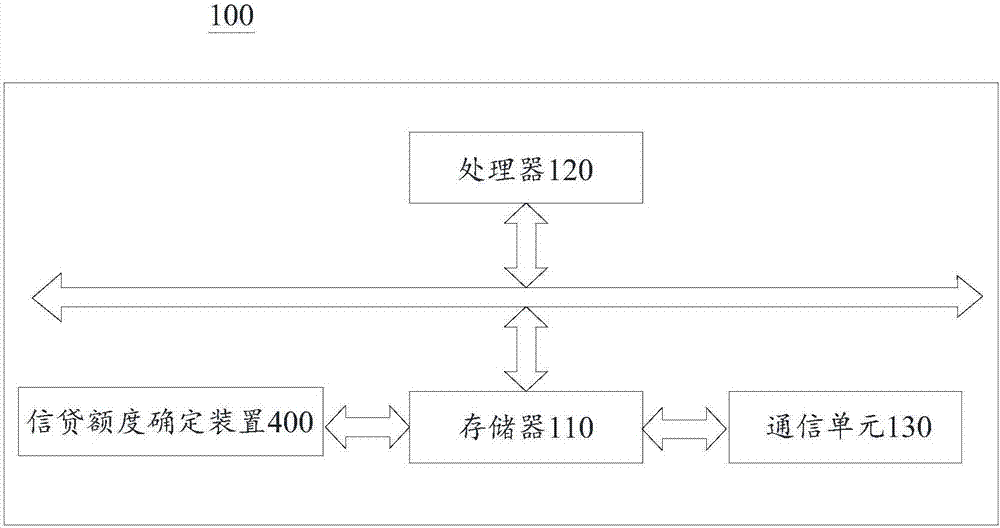

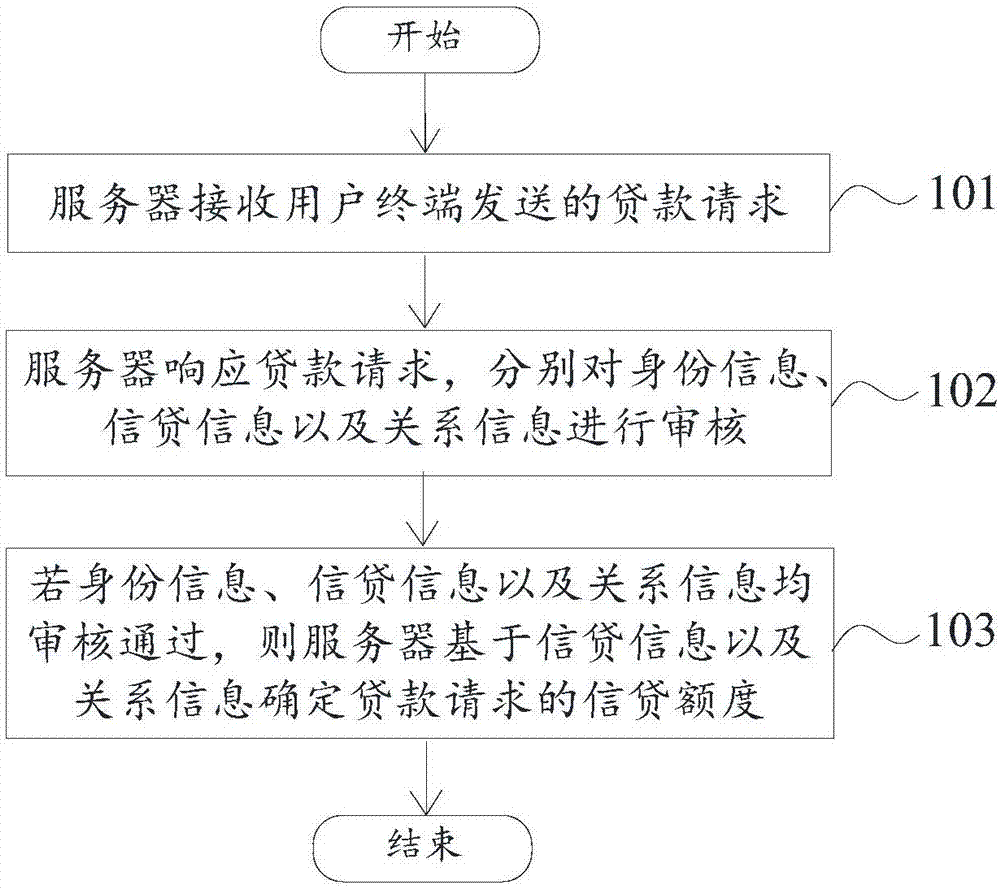

Credit line determination method and device

InactiveCN107220890AImprove experienceReduce credit riskFinanceComputer terminalKnowledge management

The invention provides a credit line determination method and device applied to a server. The method comprises the steps of: receiving a loan request of a user terminal; in response to the loan request, examining identity information, credit information and relation information respectively; and if the identity information, credit information and relation information pass the examination, determining the credit line of the loan request based on the credit information and the relation information. By adopting the method and the device, the credit line of a borrower can be improved, and the risk of a credit platform can be reduced.

Owner:SIMPLECREDIT MICRO LENDING CO LTD

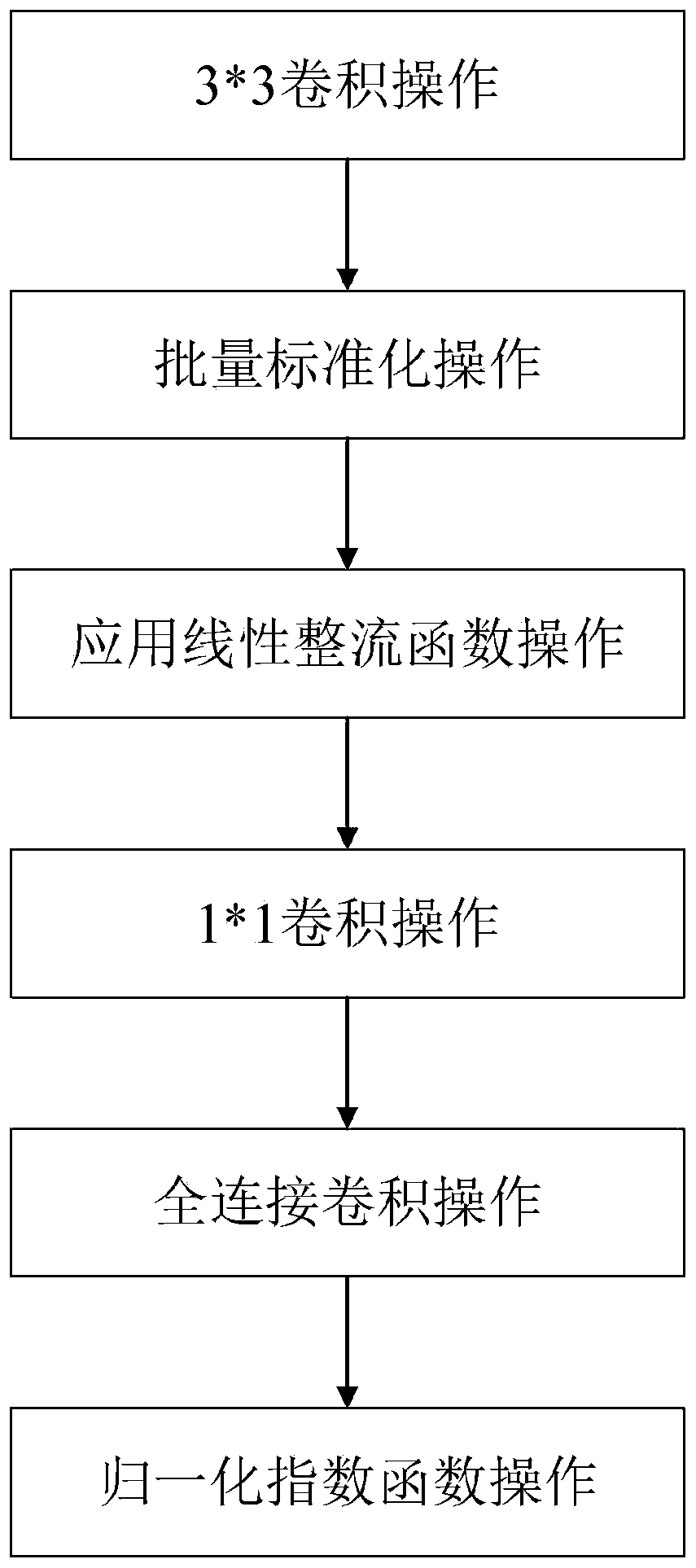

Payment big data analysis system based on Internet finance and analysis method thereof

InactiveCN114565041AReduce credit riskImprove accuracyMarket predictionsCharacter and pattern recognitionPaymentThe Internet

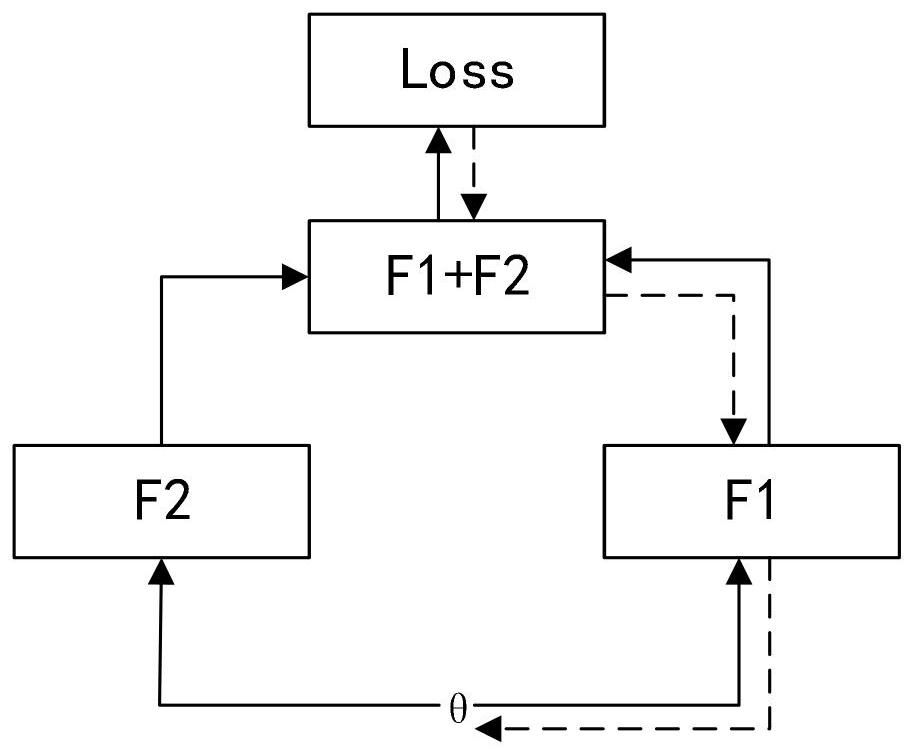

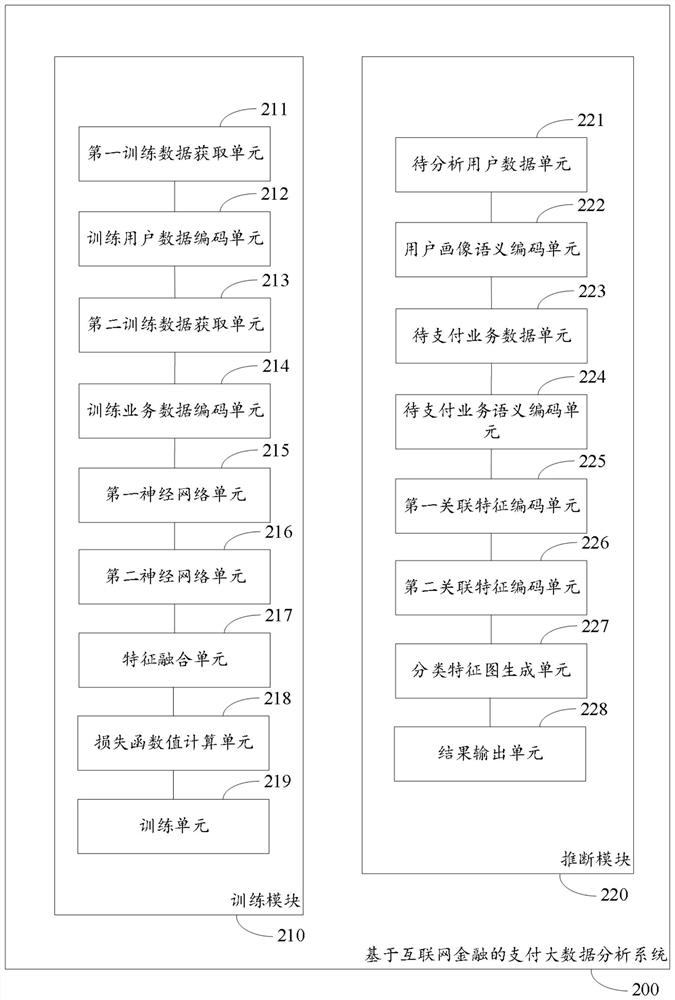

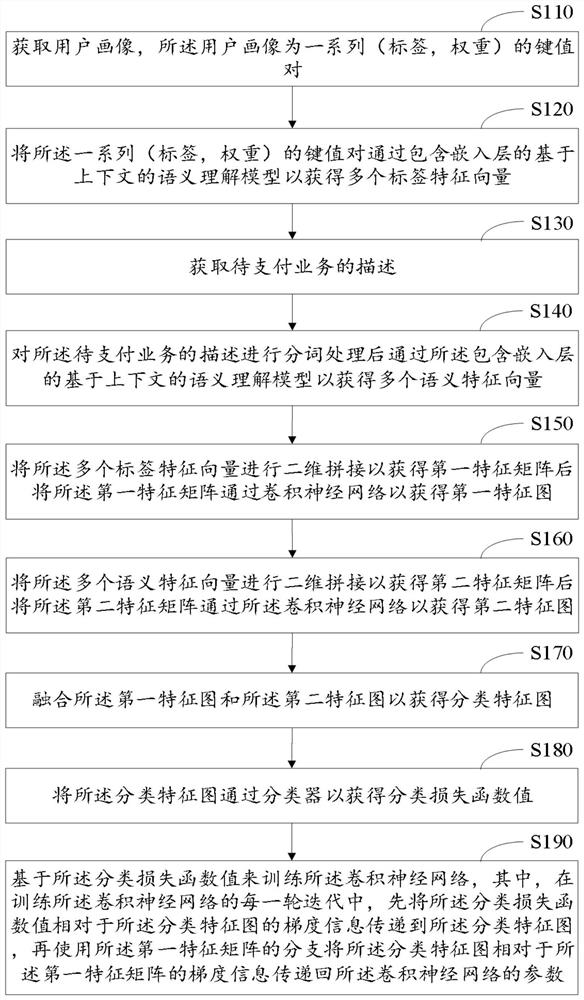

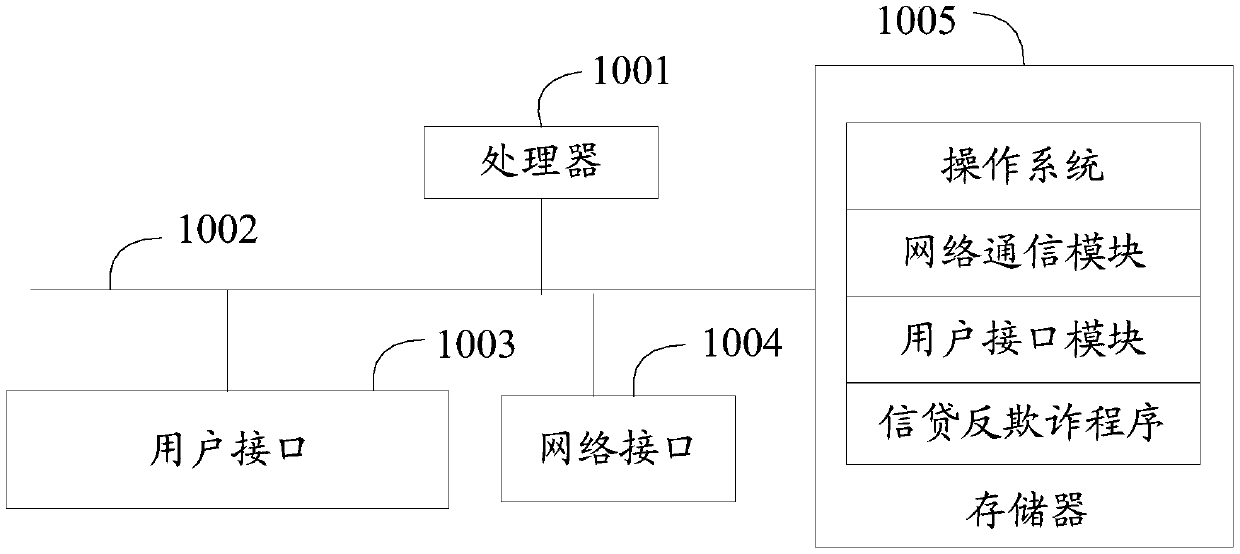

The invention relates to the field of Internet finance payment, and particularly discloses a payment big data analysis system based on Internet finance and an analysis method thereof, and the method comprises the steps: carrying out the semantic feature information extraction of the description of a user portrait and a to-be-paid service through a context-based semantic understanding model; and processing the obtained feature matrix by using the same convolutional neural network model, so that the extracted associated features have correlation as much as possible relative to the user tag features and the service semantic features in a high-dimensional feature space. And furthermore, the parameters of the convolutional neural network are updated by using a gradient transfer method, so that the classification accuracy is improved. In this way, more appropriate matching can be performed between the user and the to-be-paid service, and then the credit risk of payment of the Internet financial platform is effectively reduced.

Owner:上海嘉甲茂技术有限公司

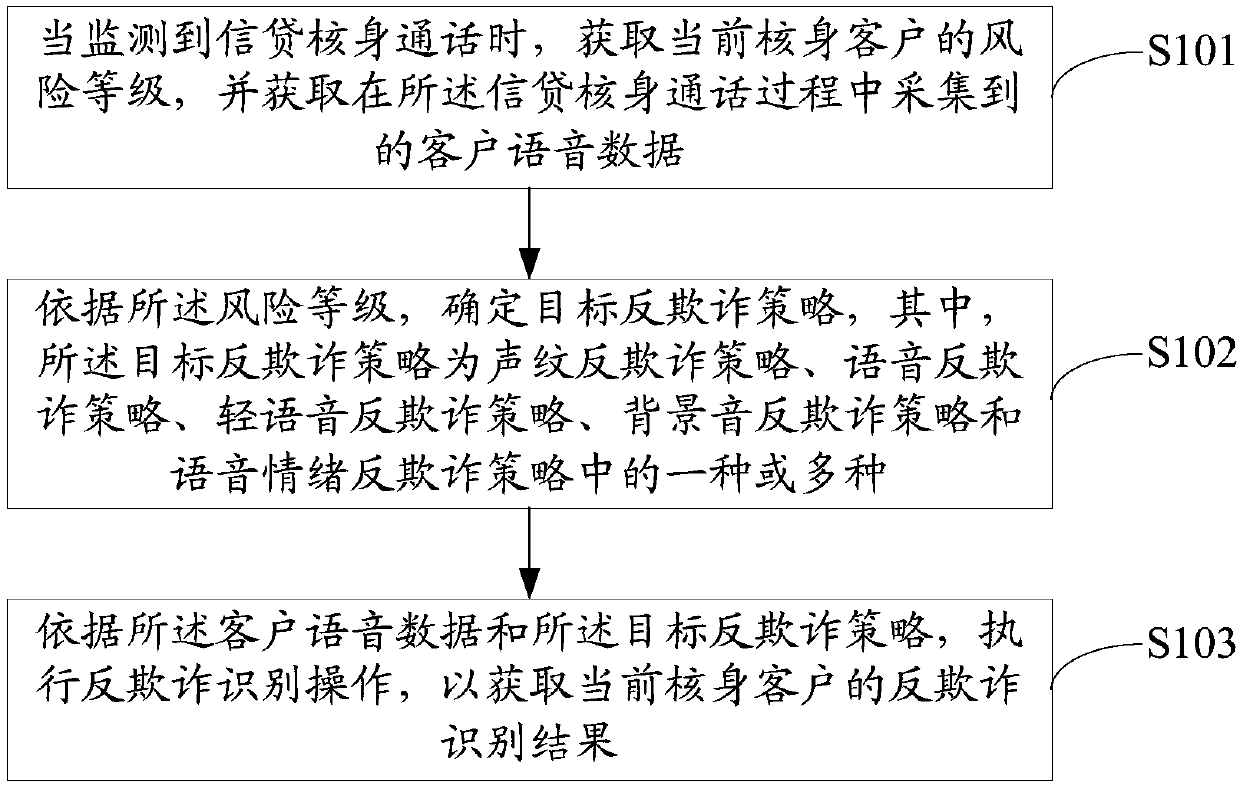

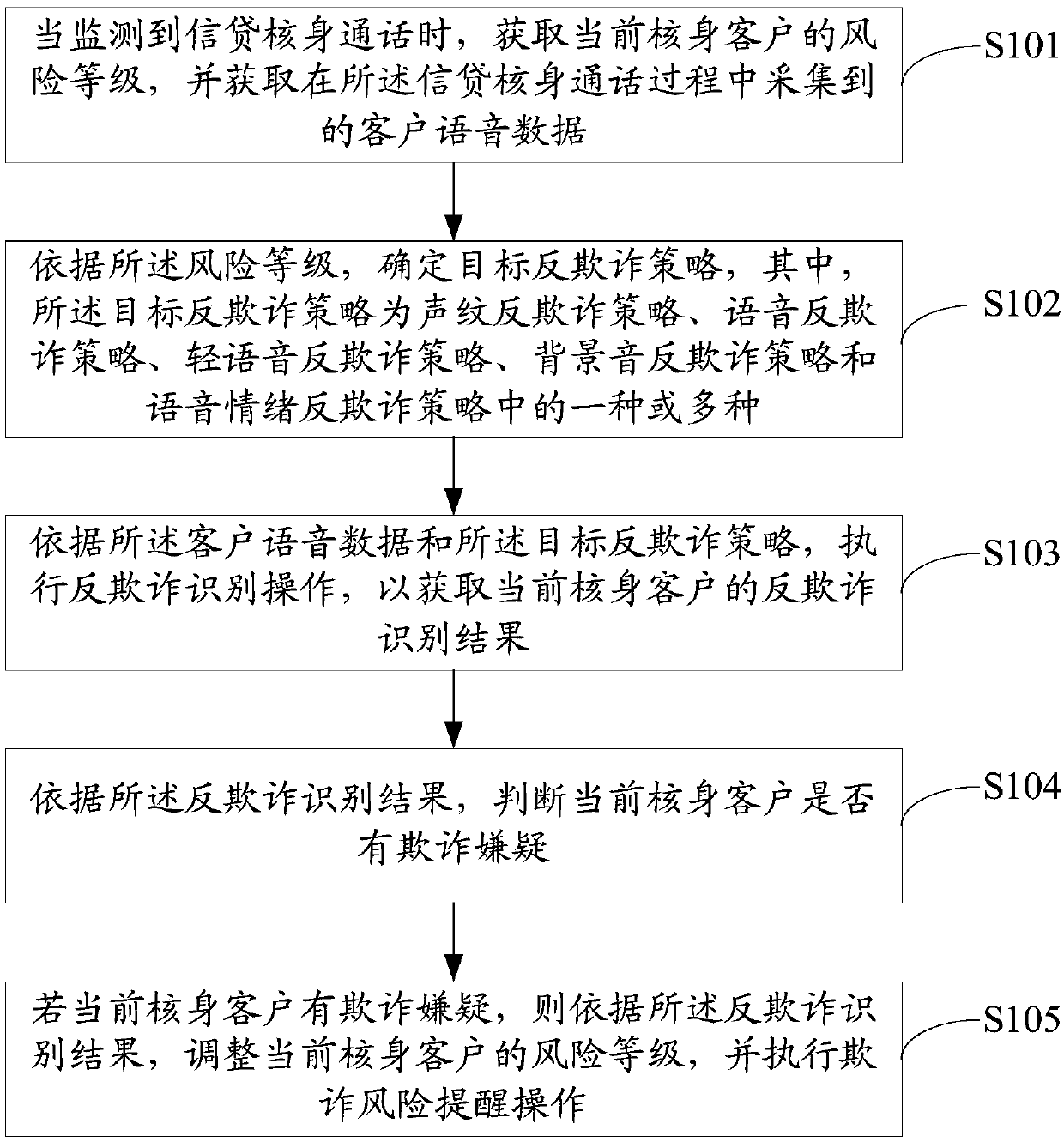

Credit anti-fraud method, system, apparatus and computer-readable storage medium

ActiveCN109544324AAccurate and comprehensive identificationEasy to identifyFinanceRisk levelSpeech sound

The invention discloses a credit anti-fraud method, which comprises the following steps: when a credit core body call is detected, obtaining the risk level of the current core body customer, and obtaining the voice data of the customer collected in the process of the credit core body call; Determining a target anti-fraud strategy according to the risk level, wherein the target anti-fraud strategyis one or more of voiceprint anti-fraud strategy, voice anti-fraud strategy, light voice anti-fraud strategy, background voice anti-fraud strategy and voice emotion anti-fraud strategy; According to the customer voice data and the target anti-fraud strategy, performing an anti-fraud identification operation to obtain an anti-fraud identification result of the current core customer. The invention also discloses a credit anti-fraud system, a device and a computer-readable storage medium. The invention can improve the identification rate and coverage rate of fraud and reduce the credit risk.

Owner:WEBANK (CHINA)

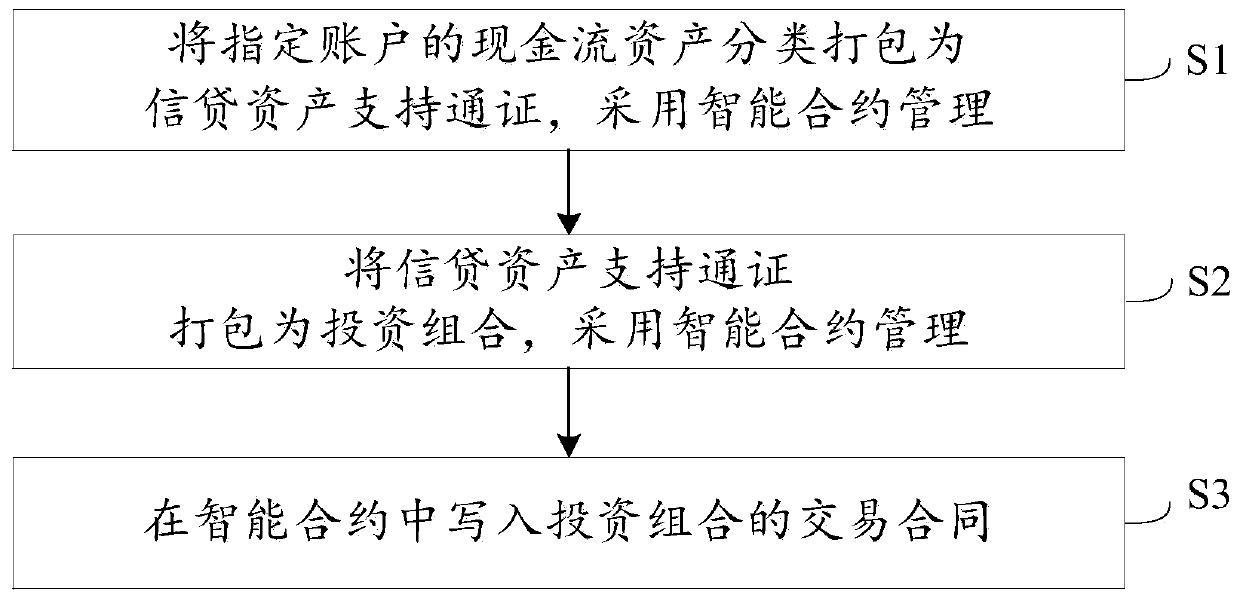

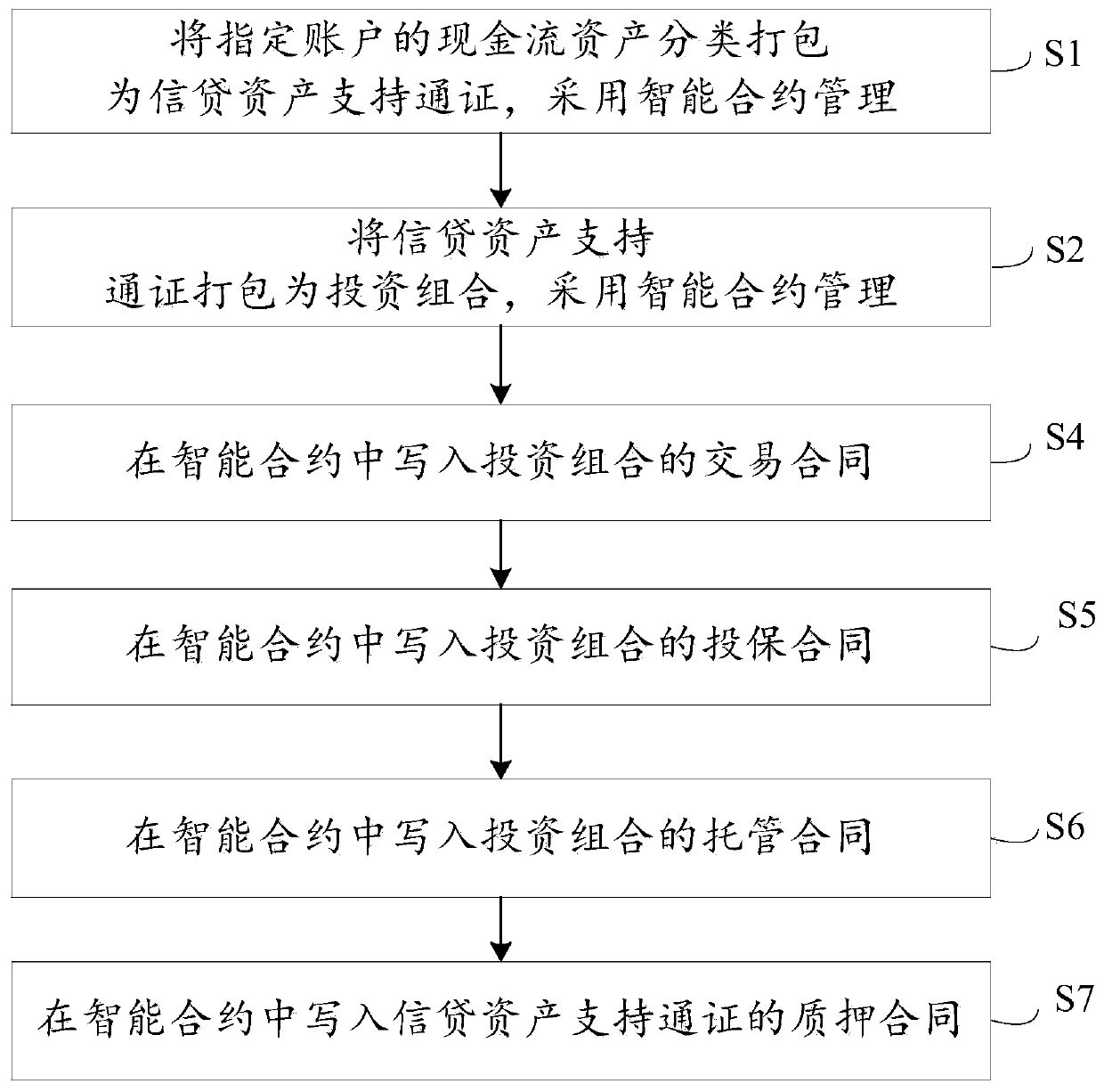

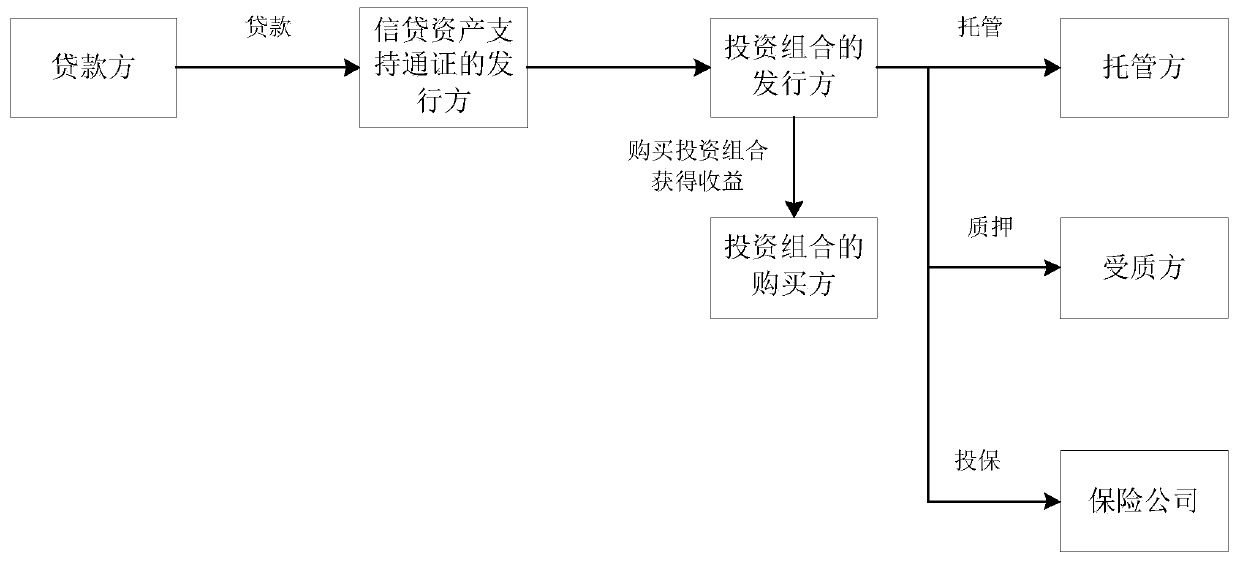

Credit asset support pass transaction method and system based on block chain

The invention discloses a credit asset support pass transaction method and system based on a block chain, wherein the method comprises the steps of classifying and packaging the cash flow assets of anappointed account into a credit asset support pass, and managing through an intelligent contract ; packaging the credit asset support pass into an investment combination, and managing the investmentcombination by adopting the intelligent contract; and writing a transaction contract of the investment combination in the intelligent contract, and enabling a buyer of the investment portfolio to obtain the earnings according to the intelligent contract. The invention provides a credit asset support pass transaction method and system based on the block chain. In combination with the block chain technology, the credit asset supporting pass transaction using the cash flow assets as security guards and the hosting, insurance and supervision of the transaction process are realized, the credit riskis reduced, and the security performance of the credit investment product transaction is improved.

Owner:ZHONGAN INFORMATION TECH SERVICES CO LTD

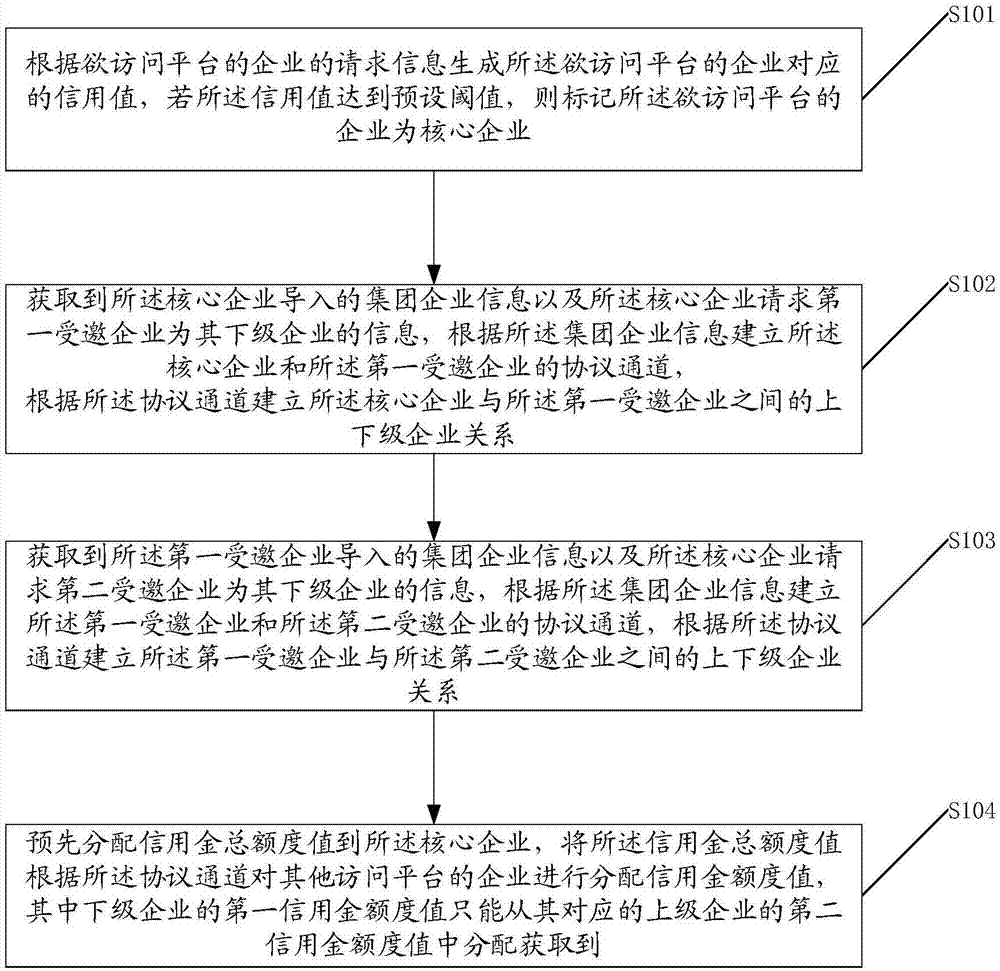

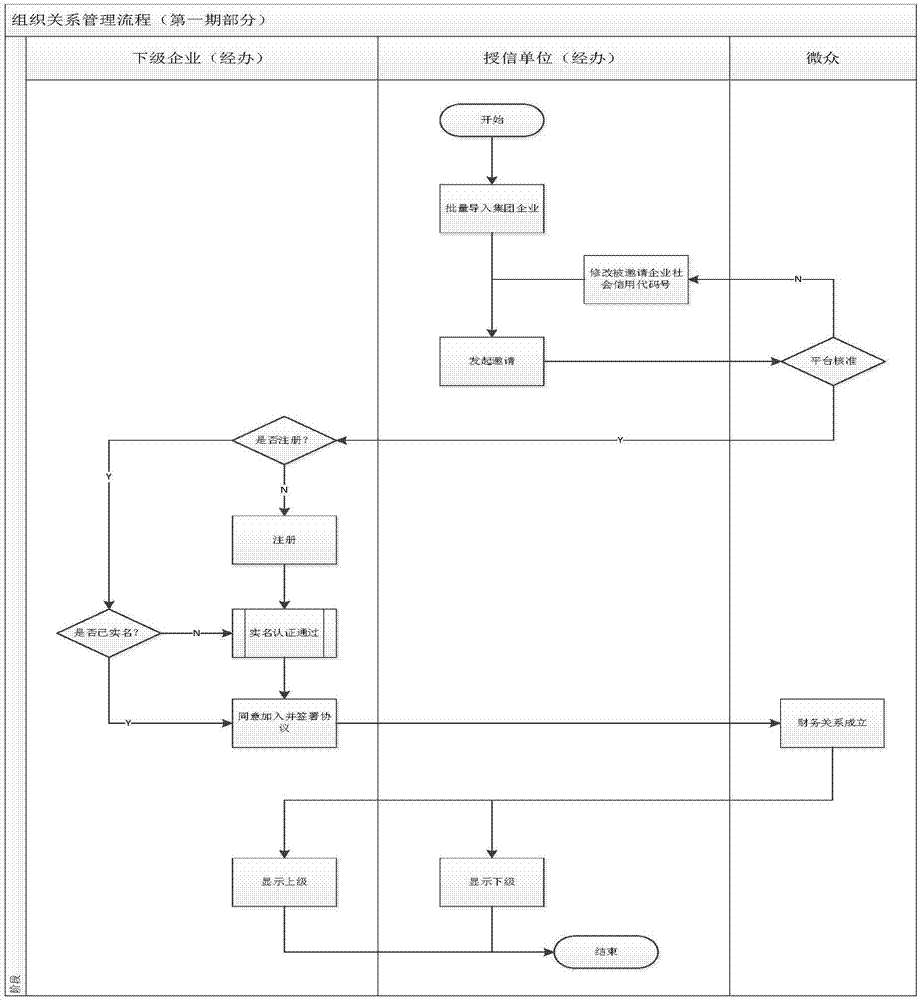

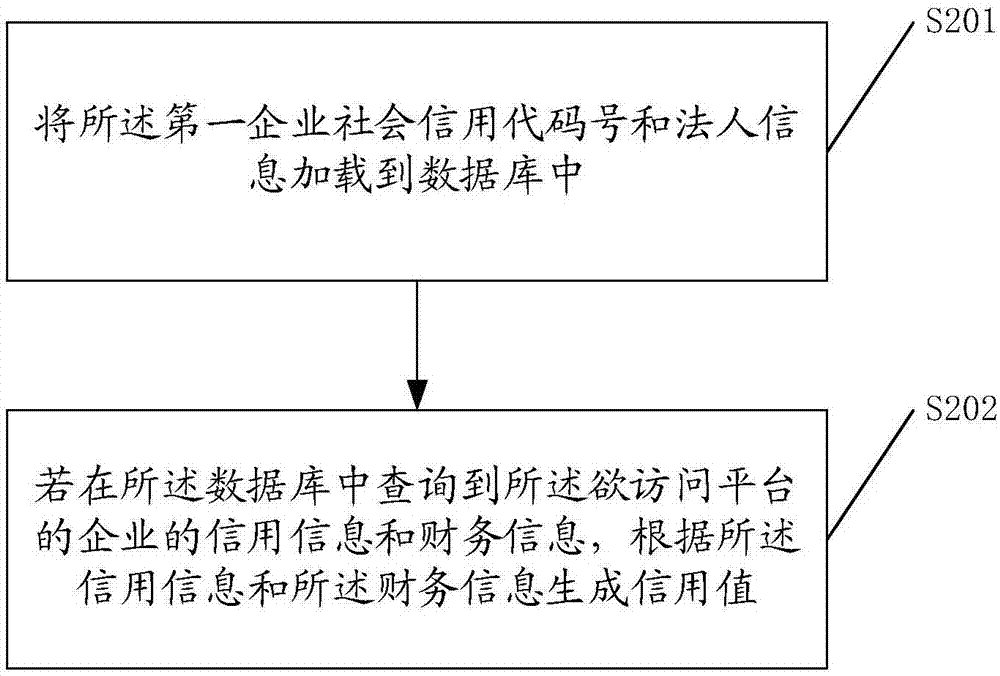

Multilevel relation management method and platform for credit money allocation

The invention relates to a multilevel relation management method and a platform for credit money allocation. The method comprises steps: through analyzing the credit value of an enterprise which is about to access the platform, the enterprise is marked as a core enterprise, and according to a protocol channel, an upper-lower enterprise relation between the core enterprise and a first invited enterprise is built; an upper-lower enterprise relation between the first invited enterprise and a second invited enterprise is built; the total credit money amount value is pre-allocated to the core enterprise, and allocation of the credit money amount value is carried out on other enterprises which access the platform according to the protocol channel. Through building the upper-lower enterprise relation, the allocation of the credit money amount value between upper and lower levels of enterprises is managed, the risk control ability is improved, the credit risks are reduced, the supervision strength is enhanced, the credit money amount allocation ability is further improved, and interests and needs of the enterprise are met.

Owner:人民金服金融信息服务(北京)有限公司

Supply chain management system based on cloud platform

InactiveCN108053154AFast updateImplementation locationForecastingResourcesLogistics managementClosed loop

The invention provides a supply chain management system based on a cloud platform, and aims at overcoming disadvantages in the prior art. The system comprises a service end and clients. The service end is loaded in the cloud platform, the cloud platform receives data of the client, the data is analyzed and processed, and corresponding feedback information is back fed to the clients. The service end comprises a waybill matching module, a financial management module, a logistics monitoring module, a vehicle condition monitoring and early warning module, a road information monitoring module and adatabase module. The clients include a vehicle mounted client, a shipping party client, a carrier client, a financial client and a consumption client. The system can update transport vehicle information in logistics of a supply chain timely, positions and progress of a transport vehicle can be monitored in the whole course, the consignment fund is closed in a closed loop way, bills and documentsare obtained timely, the logistics cost is reduced greatly, and the logistics efficiency is improved.

Owner:云南九方联达供应链管理科技有限公司

Information storage system

ActiveUS7698560B2Reduce the risk of theftReduce credit riskUser identity/authority verificationUnauthorized memory use protectionCredit cardClient-side

A system for storing information having a predetermined use which requires the information to be secured. The information may comprise credit card details used to complete a transaction. The system includes: (a) A client system for storing an encoded version of the information and an identifier. The encoded version is generated from first data of the information and an encoded version of the second data of the information. The information can be generated from the first data and the second data, and the predetermined use is infeasible with only one of the first data and the second data, (b) A remote server for storing the second data and an encoded identifier generated from the identifier. The client system sends at least the encoded version of the second data to the remote server. The client system or the remote server is able to generate the information from the first data and the second data. Accordingly, only part of the information to be secured is stored locally on the client system, whilst the other part is stored on the remote server, and neither the client system nor the remote server have a record of the entire information.

Owner:ENDRESZ ALLAN

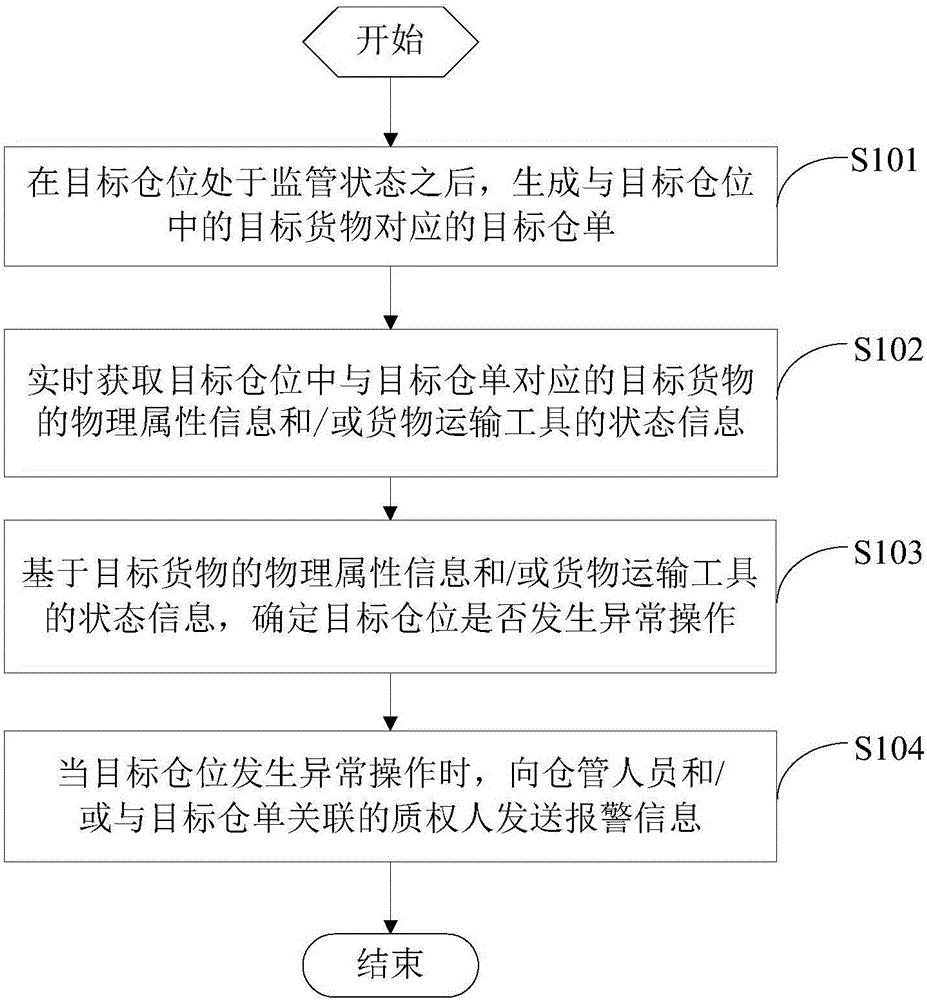

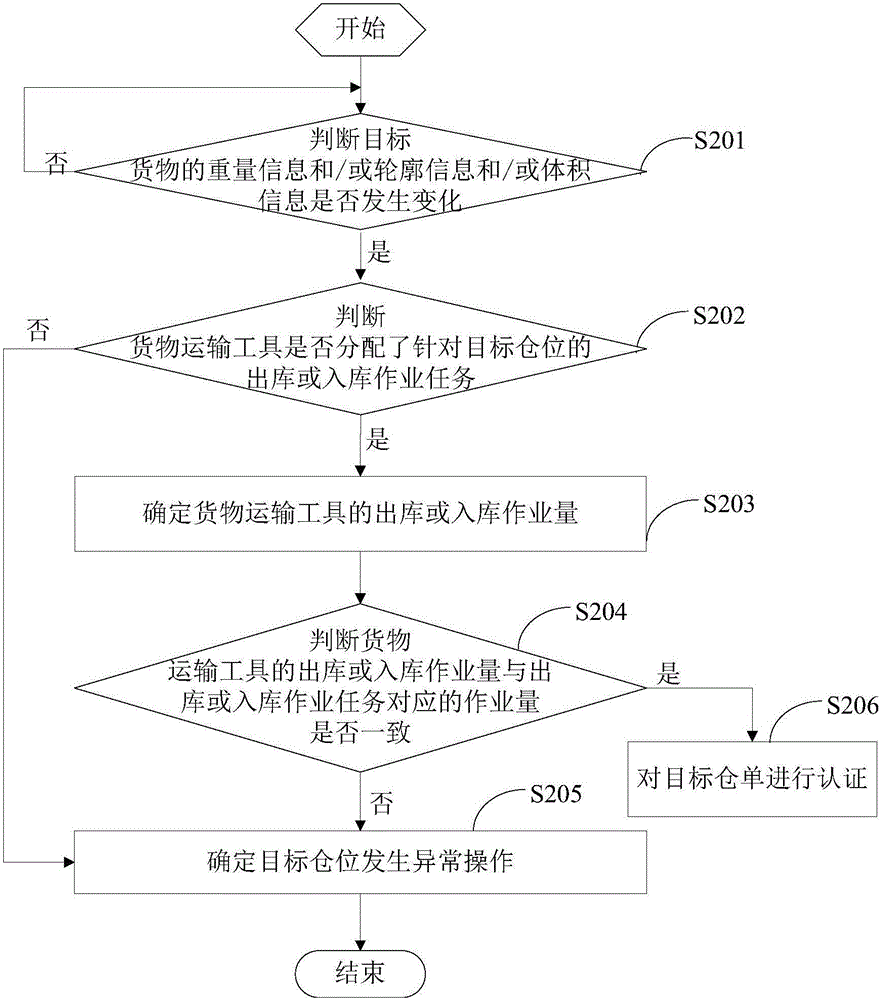

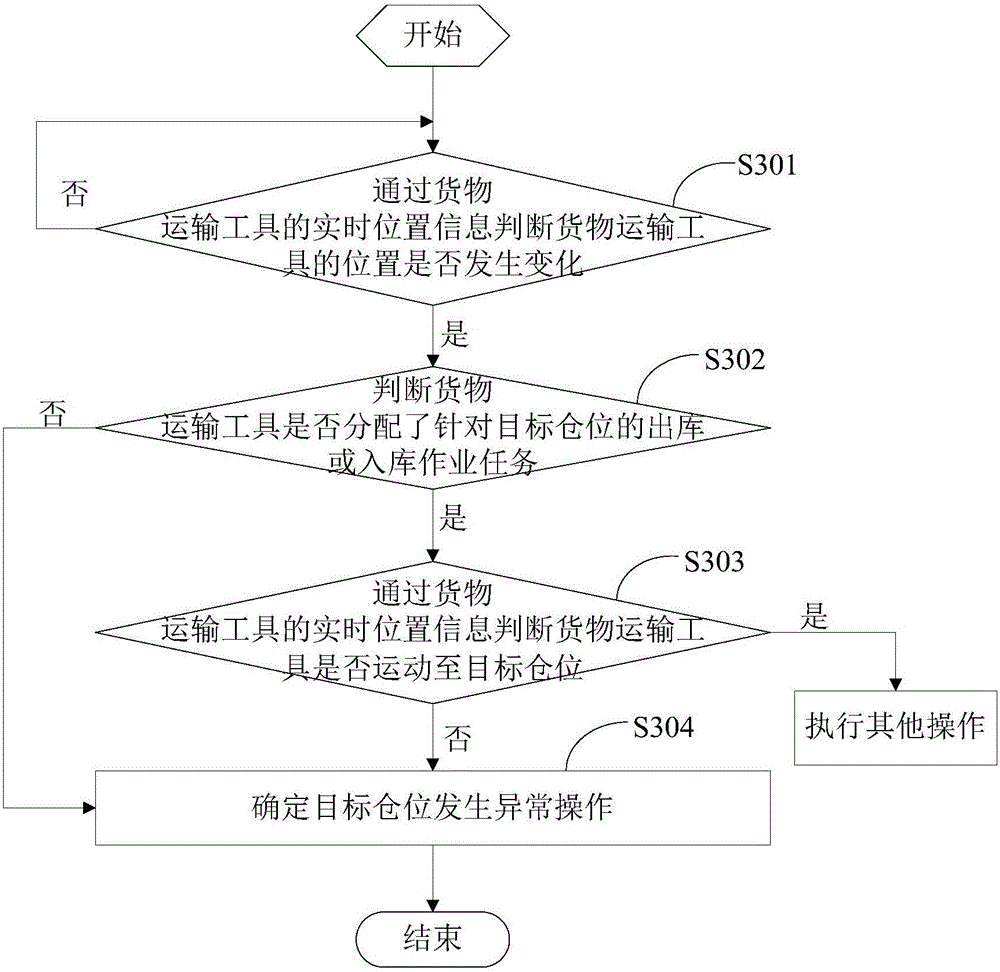

Internet of things movable property supervision method and system

The invention provides an Internet of things movable property supervision method and system. The method comprises the following steps: after a target warehouse position is at a supervision state, generating a target warehouse receipt corresponding to target goods in the target warehouse position; obtaining in real time physical attribute information of the target goods corresponding to the target warehouse receipt in the target warehouse position and / or state information of goods transport tools; based on the physical attribute information of the target goods and / or the state information of the goods transport tools, determining whether abnormal operation happens in the target warehouse position; and if yes, sending alarm information to warehouse management personnel and / or pledgees associated with the target warehouse receipt. According to the invention, the target warehouse receipt is endowed with real-time and real target goods information, the pledgees are notified when target goods risks occur, such a supervision mode changes a conventional supervision mode featuring too much manual intervention and low efficiency in the prior art, the problem of warehouse receipt repetition caused by too much manual intervention is avoided, and the credit risks of banks are greatly reduced.

Owner:无锡感知金服物联网科技有限公司

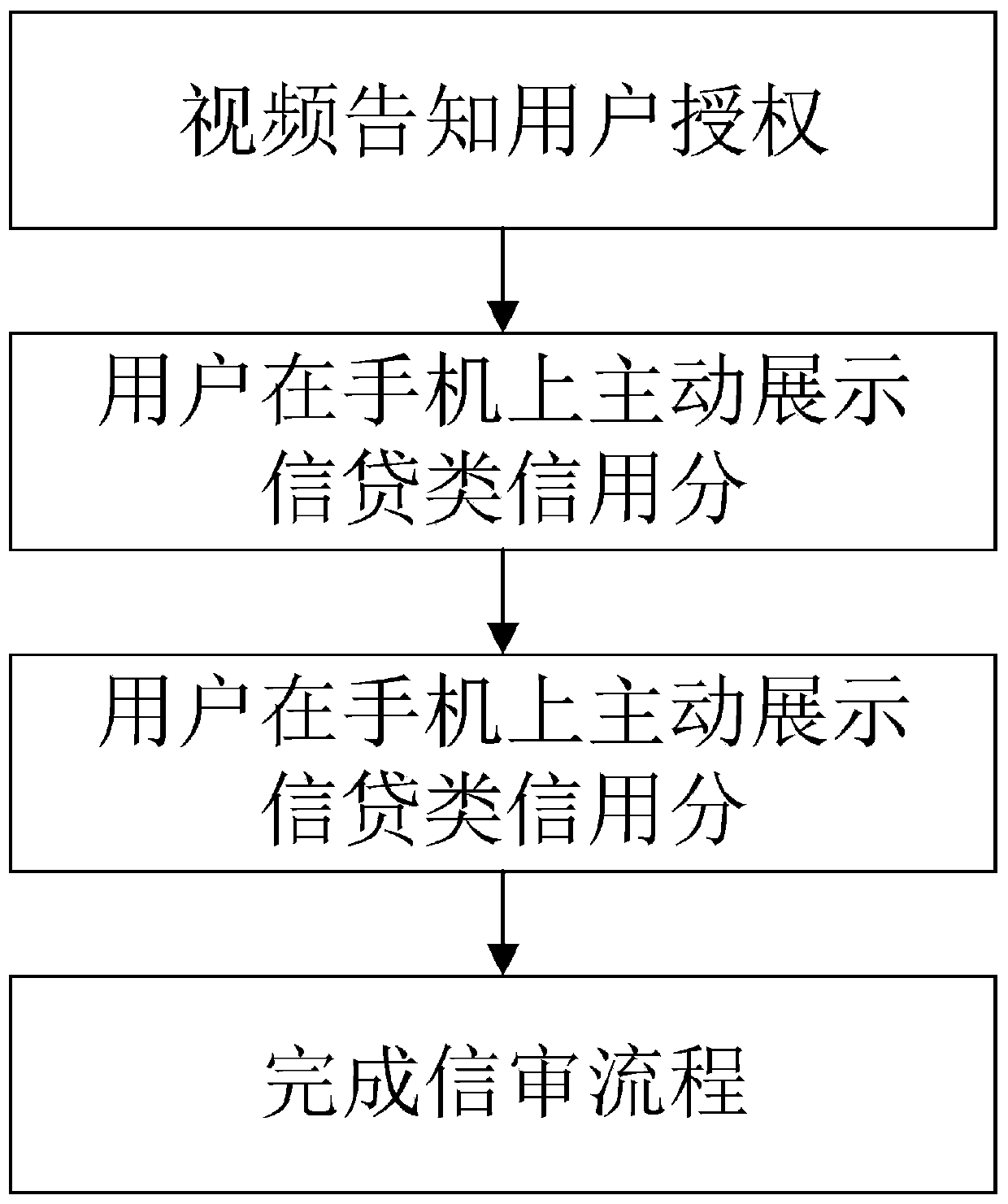

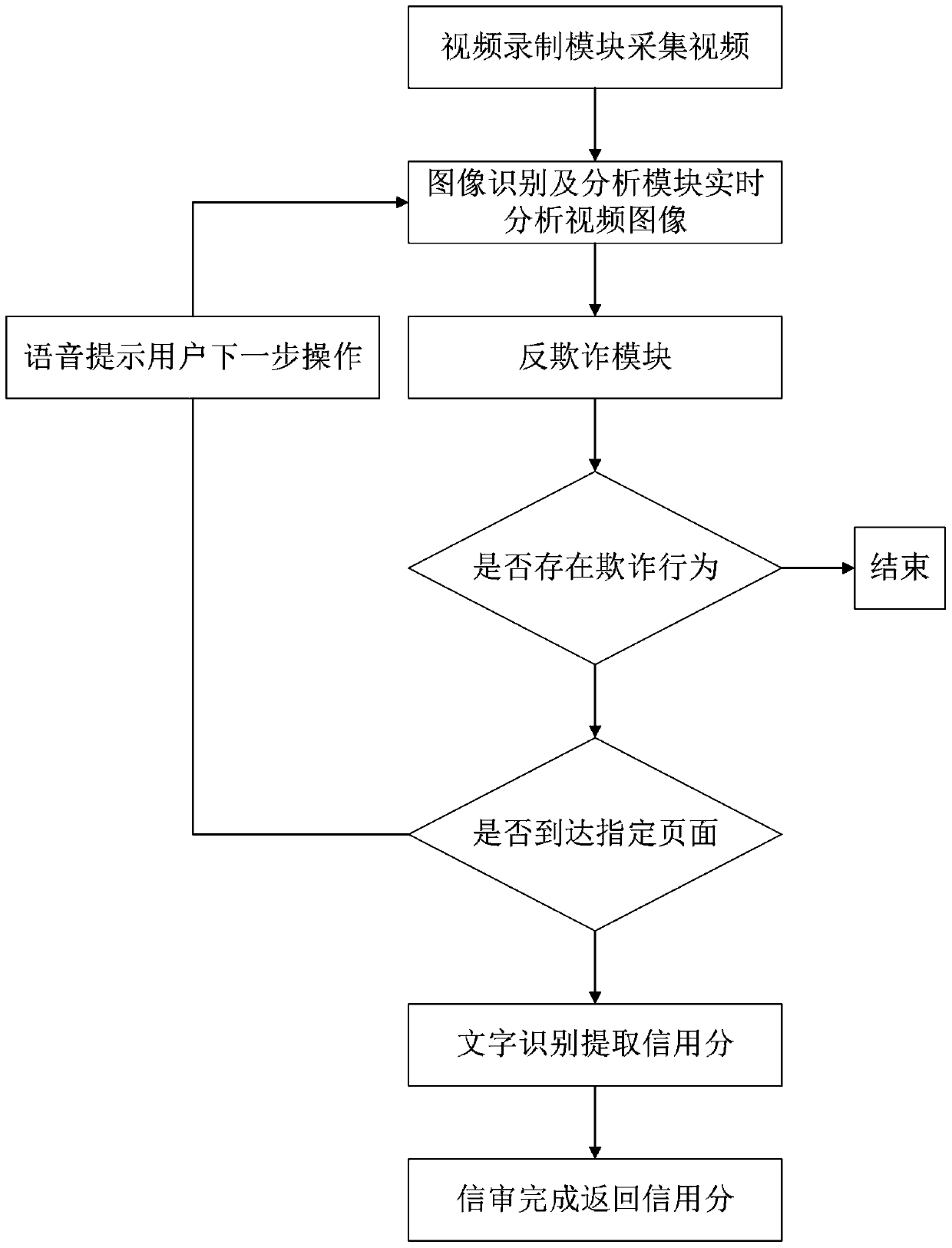

Intelligent credit and information authentication system and method

InactiveCN109801161AReduce credit riskReduce economic lossFinanceCharacter and pattern recognitionAuthentication systemImage analysis

The invention provides an intelligent credit and information authentication system and method, and the system comprises a video recording module which is used for obtaining image collection data collected by a user at a remote terminal through an intelligent terminal used by the user; The image recognition and analysis module is used for forming picture image data after obtaining the video image data, carrying out image recognition and analysis according to an image analysis algorithm, and carrying out text data verification through a text analysis algorithm after image verification is passed;The voice guiding module is used for guiding the user to operate a corresponding recognition and authentication process through voice, reminding the user by using the synthesized voice and entering an authorization page according to a safety recognition and authentication condition; The anti-fraud module is used for identifying whether the user identity information is user identity information ornot; And when the user uses other people screenshot data or the image data subjected to image modification for identity authentication, the image recognition and analysis module judges whether the user is a fraudulent behavior or not, and transmits the fraudulent behavior to the remote terminal to record the information authentication operation.

Owner:上海诚数信息科技有限公司

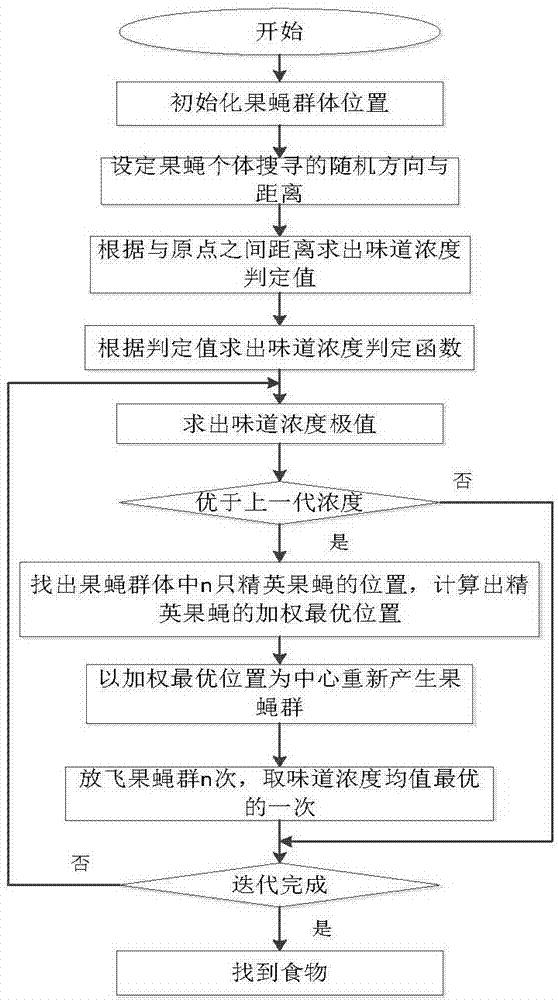

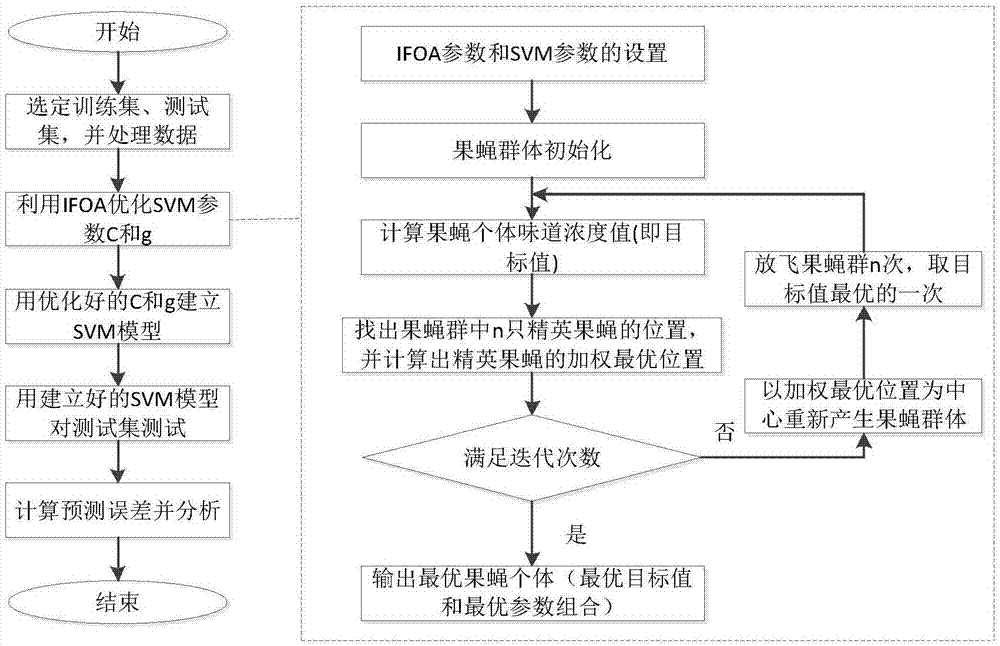

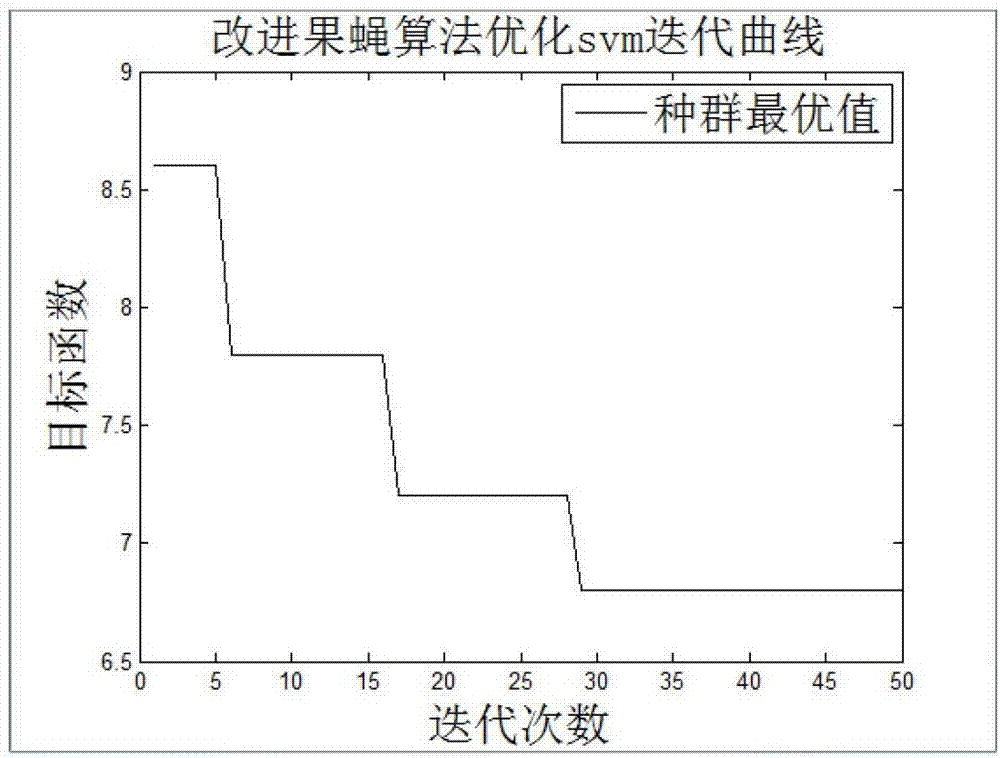

Personal credit risk assessment method based on IFOA-SVM

InactiveCN107330781AImprove search efficiencyGuaranteed Search AccuracyFinanceCharacter and pattern recognitionSupport vector machineAlgorithm

The present invention discloses a personal credit risk assessment method based on an IFOA-SVM (Improving Fruit Fly Optimization Algorithm-Support Vector Machine). An improving fruit fly optimization algorithm is employed to perform improvement to effectively ensure the optimization precision while improving the optimization efficiency of the algorithm. The IFOA is configured to find out n elite fruit fly positions with optimal taste concentration at present and perform weighting processing of the positions to obtain an optimal weighting position so as to allow a fruit fly group to fly to the positions. The releasing operation is performed for n times to select one releasing with the optimal taste concentration mean value. The improving fruit fly optimization algorithm improves the searching probability of an optimum solution, speeds up the searching speed of the optimum solution and utilizes the optimum solution to the credit risk assessment to obtain a good assessment result, and the quantization processing of the credit assessment indexes in the sample data is performed to improve the prediction performance, have good practicability, clear out loan client credit for financing institutions such as a bank and the like and provide effective basis for reduction of the loan risk.

Owner:NANJING UNIV OF INFORMATION SCI & TECH

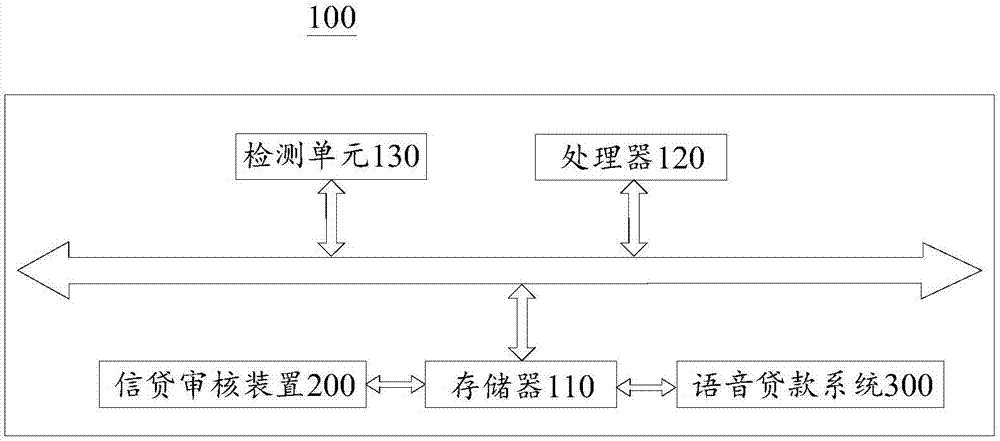

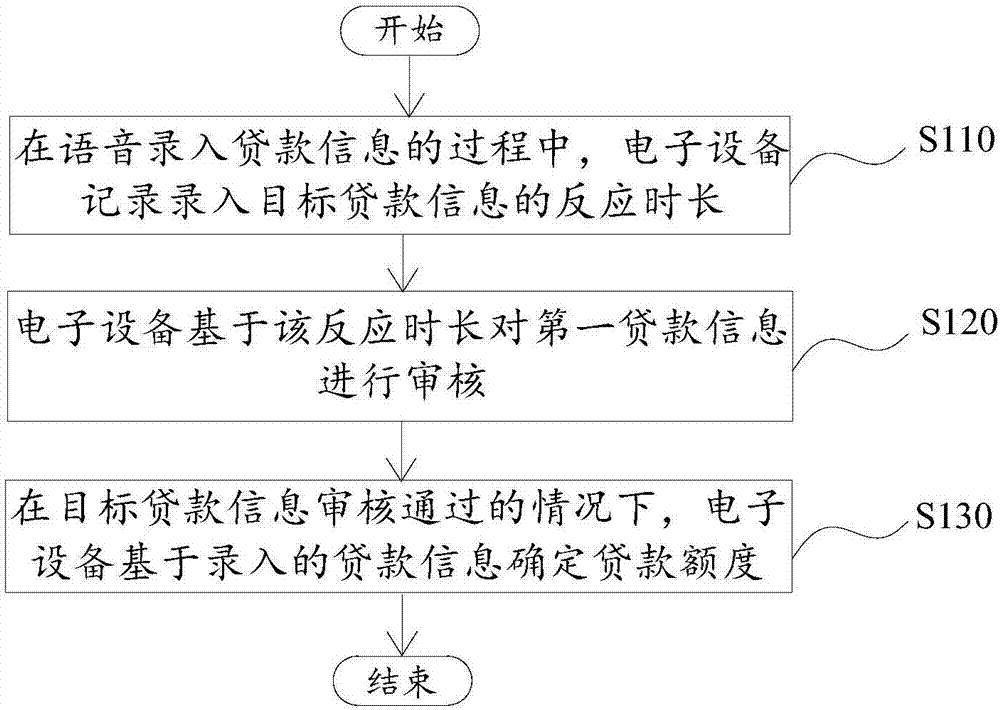

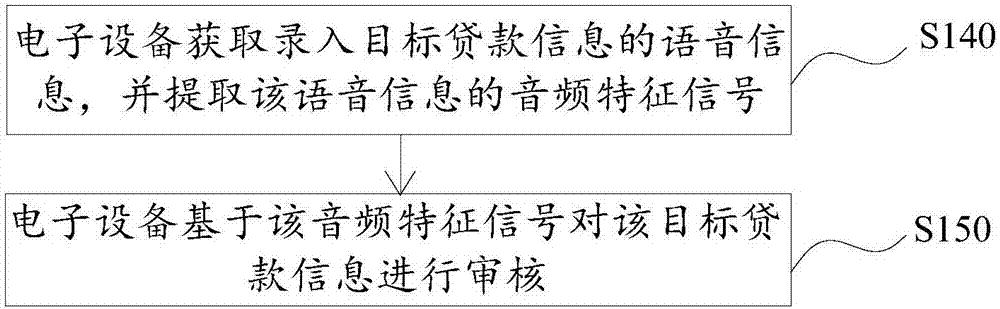

Information audit method and device

PendingCN107392757AImprove accuracyCorrect credit decisionFinanceSpeech recognitionComputer scienceSpeech sound

The present invention provides an information audit method and device. The method and device are applied to a voice loan system configured to record entering loan information through a voice mode. The method comprises: in the process of voice entering load information, recording reaction duration of recording target loan information, wherein the reaction duration is a time interval configured to perform prompt from the ending of voice broadcast of entering target loan information to starting of entering the target loan information; performing audit of the target loan information based on the reaction duration; and in the condition of passing of the target loan information audit, determining the loan limit based on the entered loan information. Therefore, the accuracy of the loan information audit can be improved, and the credit risk of a credit and loan platform. Besides, the loan information is audited through the reaction duration, and the information audit method and device are more accurate and rapid so as to greatly improve the audit efficiency compared to a traditional audit mode.

Owner:SIMPLECREDIT MICRO LENDING CO LTD

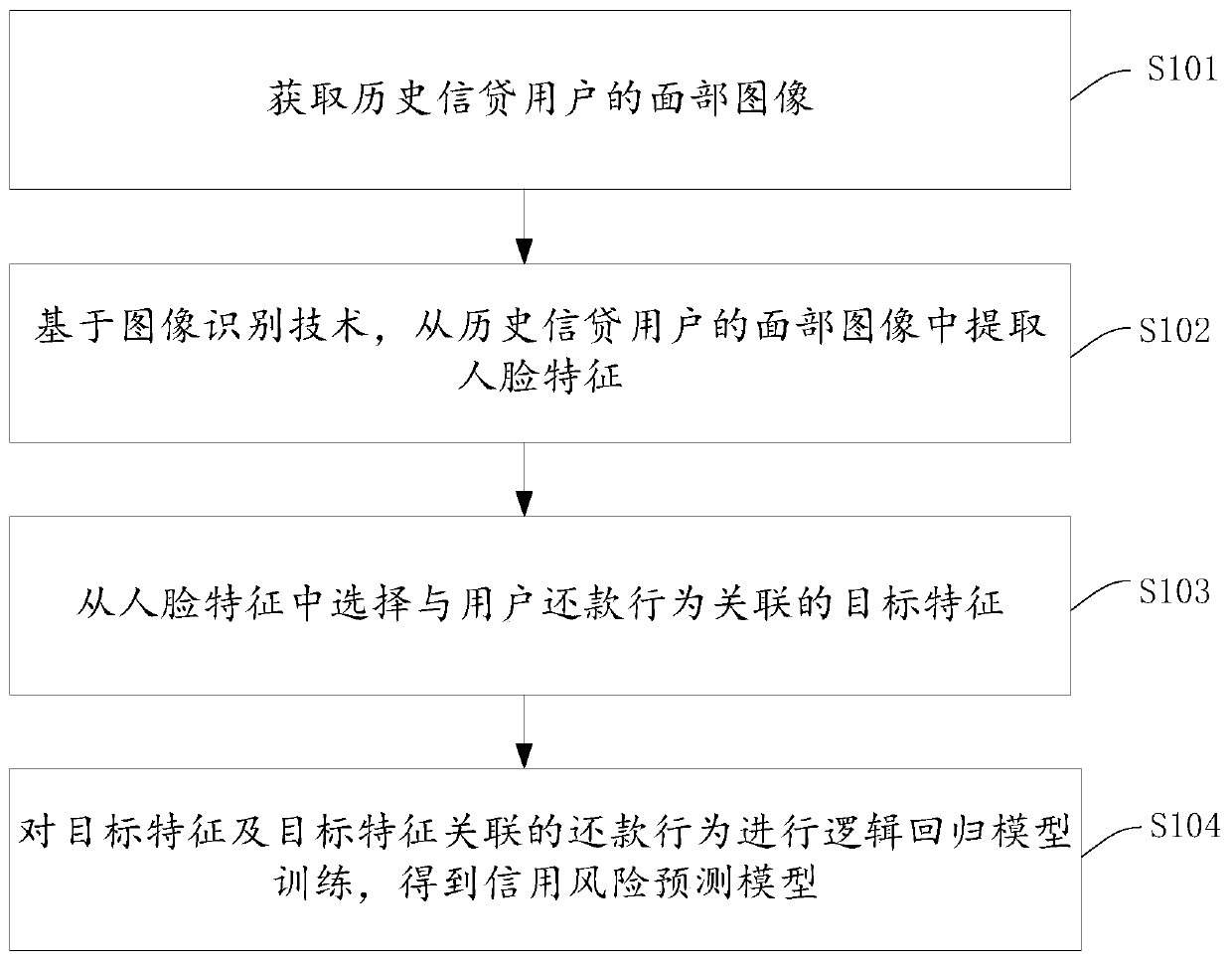

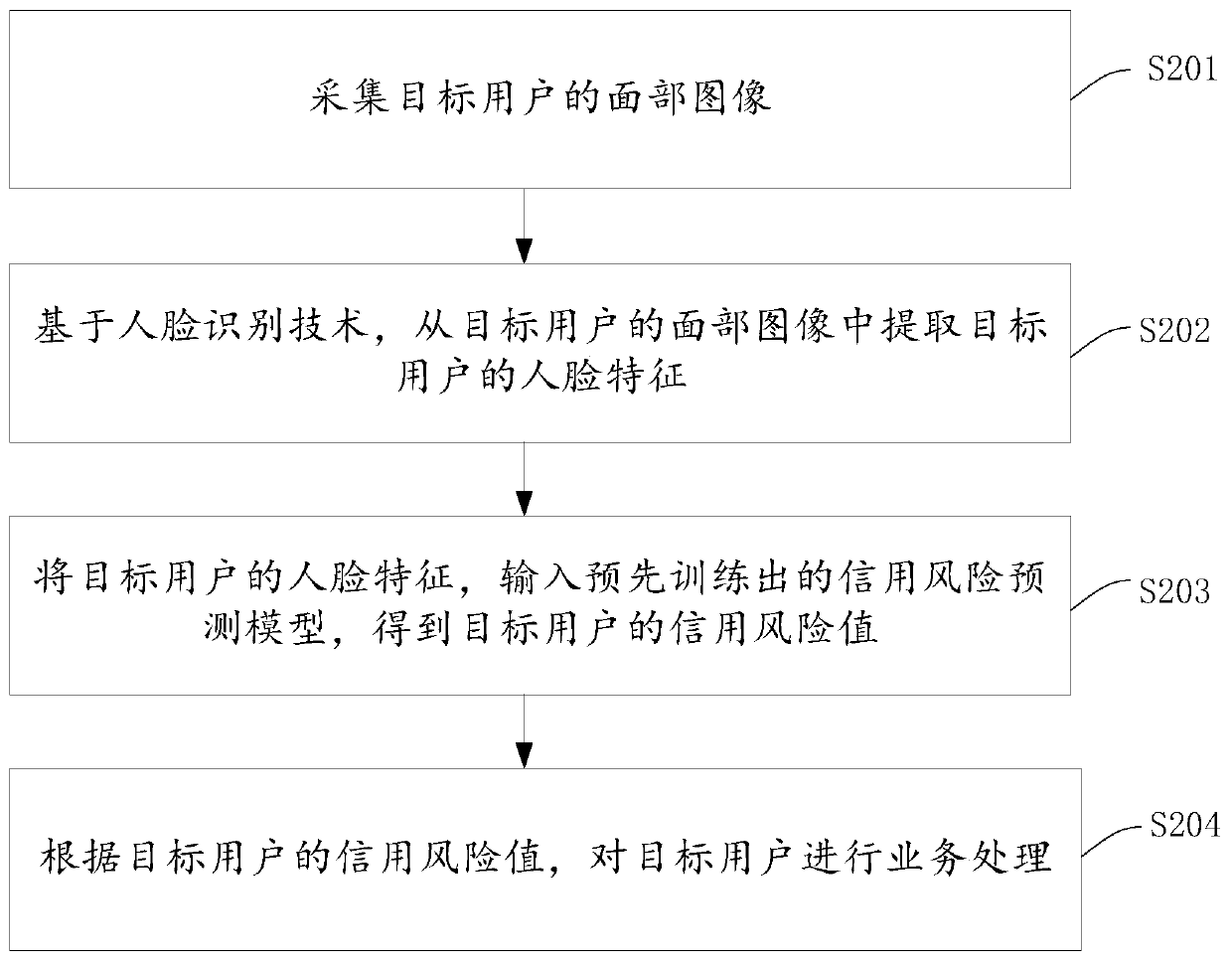

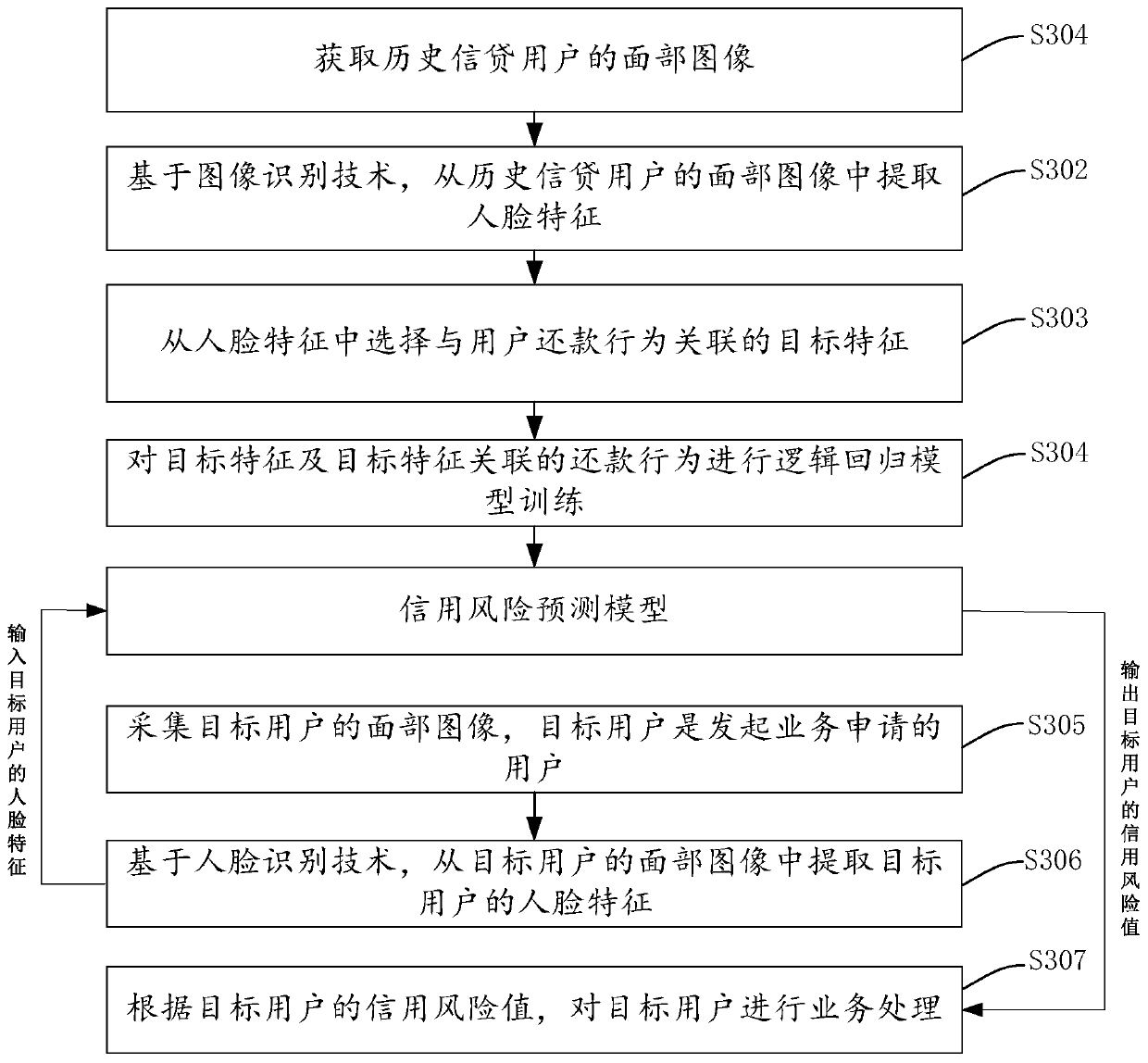

Business processing method, model training method, equipment and storage medium

InactiveCN110110592AReduce credit riskFinanceCharacter and pattern recognitionData miningData science

The embodiment of the invention provides a service processing method, a model training method, equipment and a storage medium. In some exemplary embodiments of the present application, a server devicepre-trains a credit risk prediction model, a computing device collects a face image of a target user, and extracts face features of the target user from the face image of the target user based on a face recognition technology; inputting the face features of the target user into a pre-trained credit risk prediction model to obtain a credit risk value of the target user; and performing service processing on the target user according to the credit risk value of the target user to reduce the service risk.

Owner:PEOPLE'S INSURANCE COMPANY OF CHINA

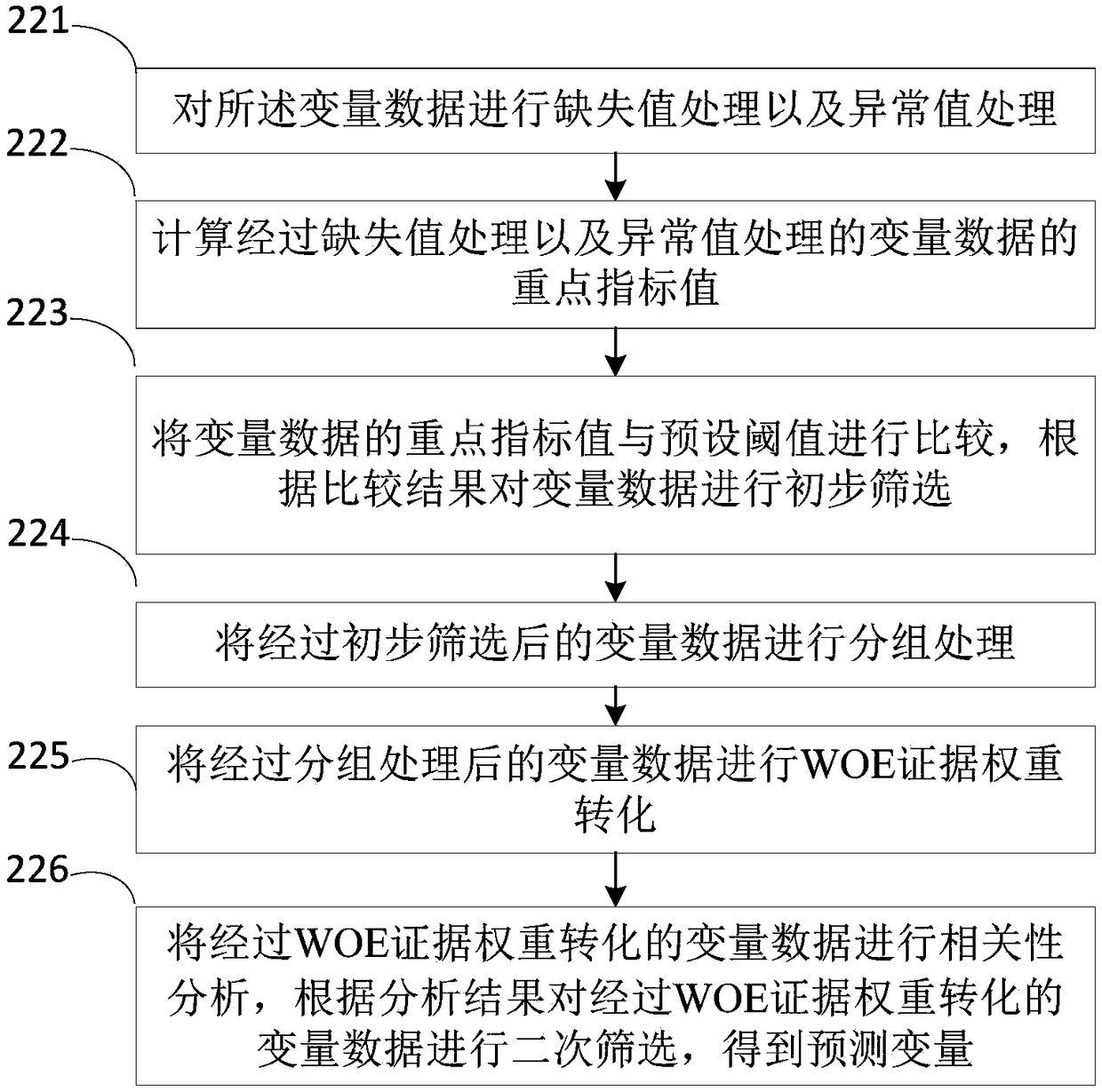

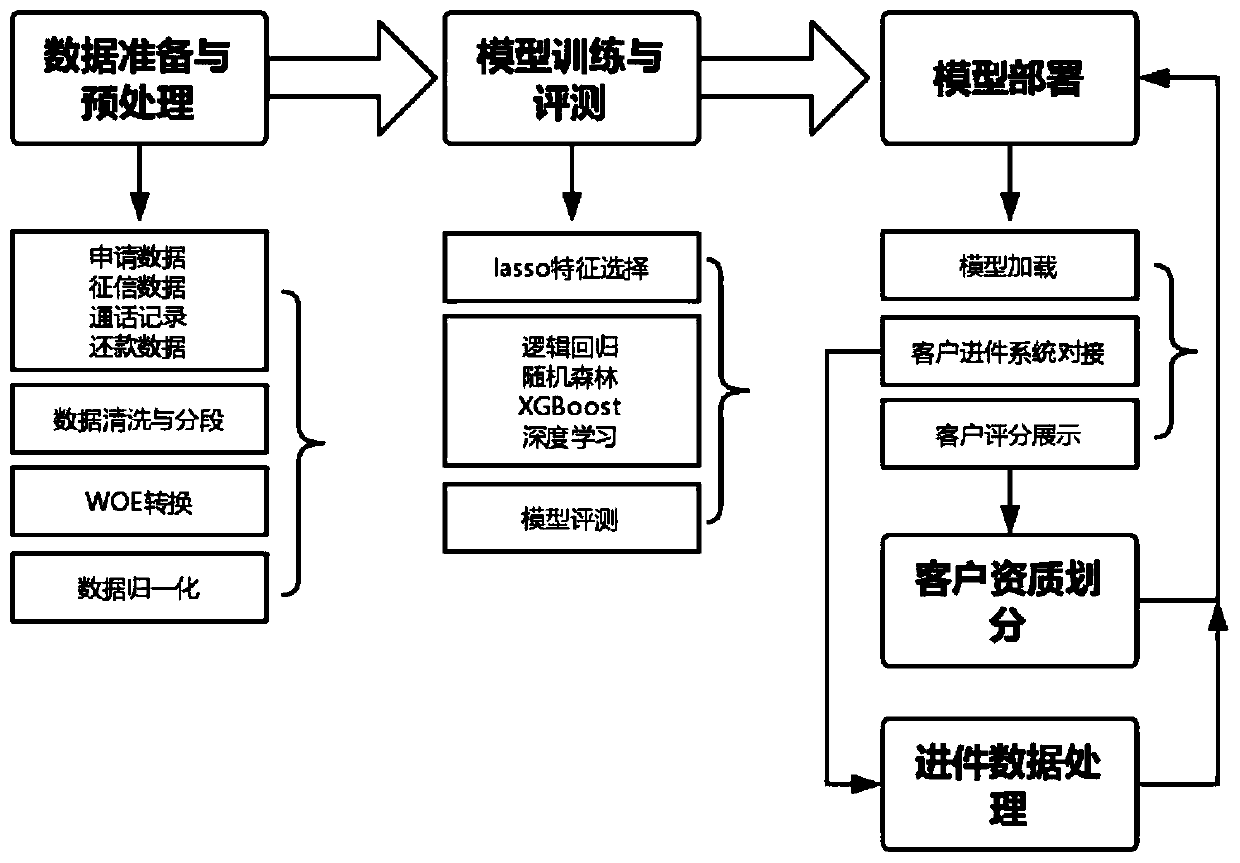

Credit customer qualification classification method based on WOE conversion through machine learning

PendingCN110322335AImprove bindingReduce the impact of noiseFinanceCharacter and pattern recognitionOriginal dataClassification methods

The invention discloses a credit customer qualification classification method based on WOE conversion through machine learning. A system comprises a data preparation and preprocessing module, a modeltraining and evaluating module, a model deployment module, an inlet data processing module and a client qualification division module. The data preparation and preprocessing module is used for calculating original data I from the application data, the credit investigation data and the call record, calculating original data II through the customer category and the repayment data, and carrying out data preprocessing on the original data I and the original data II. The invention relates to the technical field of qualification classification. The credit customer qualification classification methodbased on WOE conversion through machine learning provides the system for realizing customer classification with different qualifications based on the machine learning method, the workload of manual auditing can be reduced, the approval efficiency is improved, learning is performed in time according to newly added customer information, self-adaption to customer qualification change is realized, the manual auditing efficiency can be improved to a greater extent, and the labor cost is reduced.

Owner:梵界信息技术(上海)股份有限公司

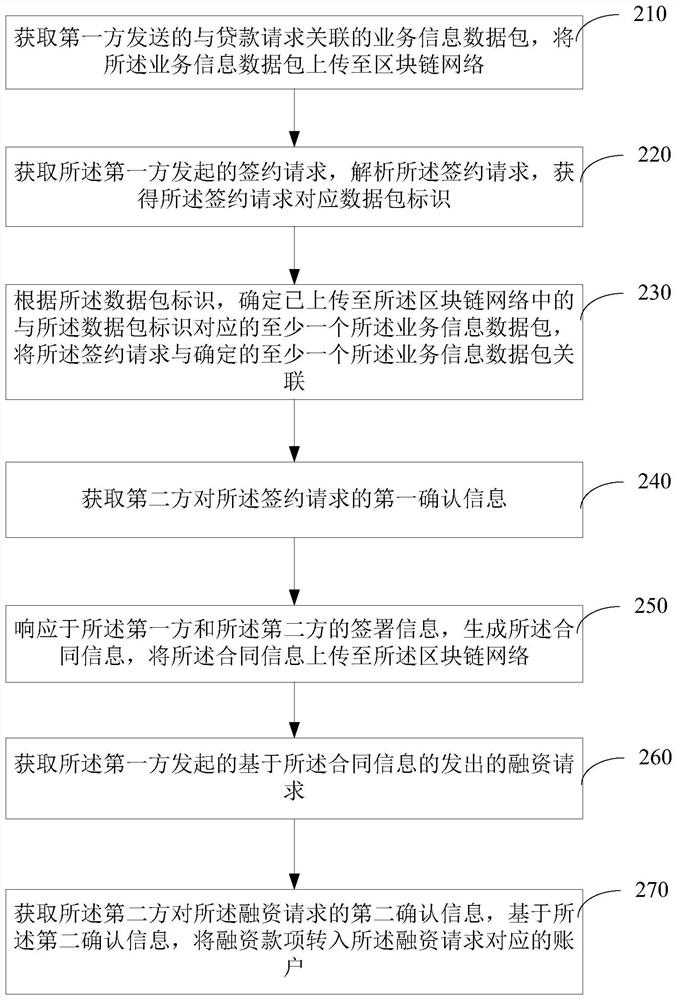

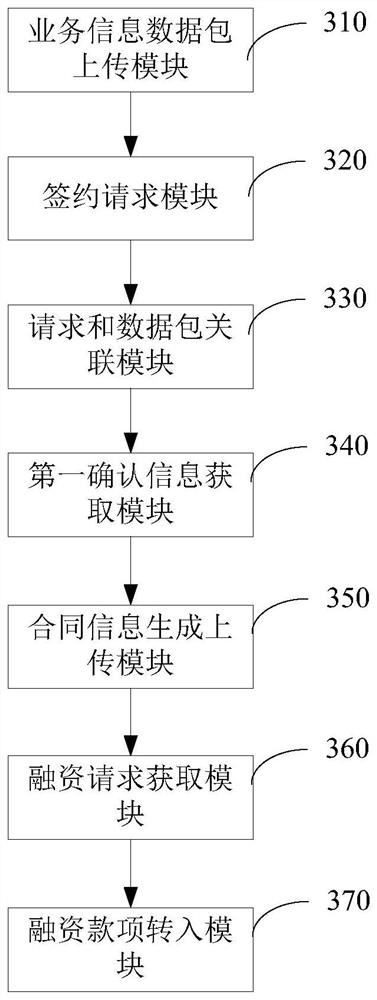

Block chain-based credit data processing method and device, computer and medium

PendingCN112862587AImprove securityIncrease credibilityFinanceDigital data protectionData packChain network

The invention provides a blockchain-based credit data processing method and device, a computer and a medium, and the method comprises the steps: obtaining a business information data packet of a first party, and uploading the business information data packet to a blockchain network; generating contract information in response to the signing information of the first party and the second party, and uploading the contract information to the block chain network; obtaining a financing request initiated by a first party; and transferring the financing fund to an account corresponding to the financing request based on the second confirmation information. The business information data packet of the first party is uploaded to the block chain network, the privacy information of the user is protected by using the encryption technology of the block chain, and the contract information signed by the first party and the second party is uploaded to the block chain network, so that the security and credibility of contract information storage are improved, and a decentralized storage mode of the block chain is adopted, so that the business information data packet and the contract information can be stored more quickly, and tampering is effectively avoided.

Owner:石化盈科信息技术有限责任公司

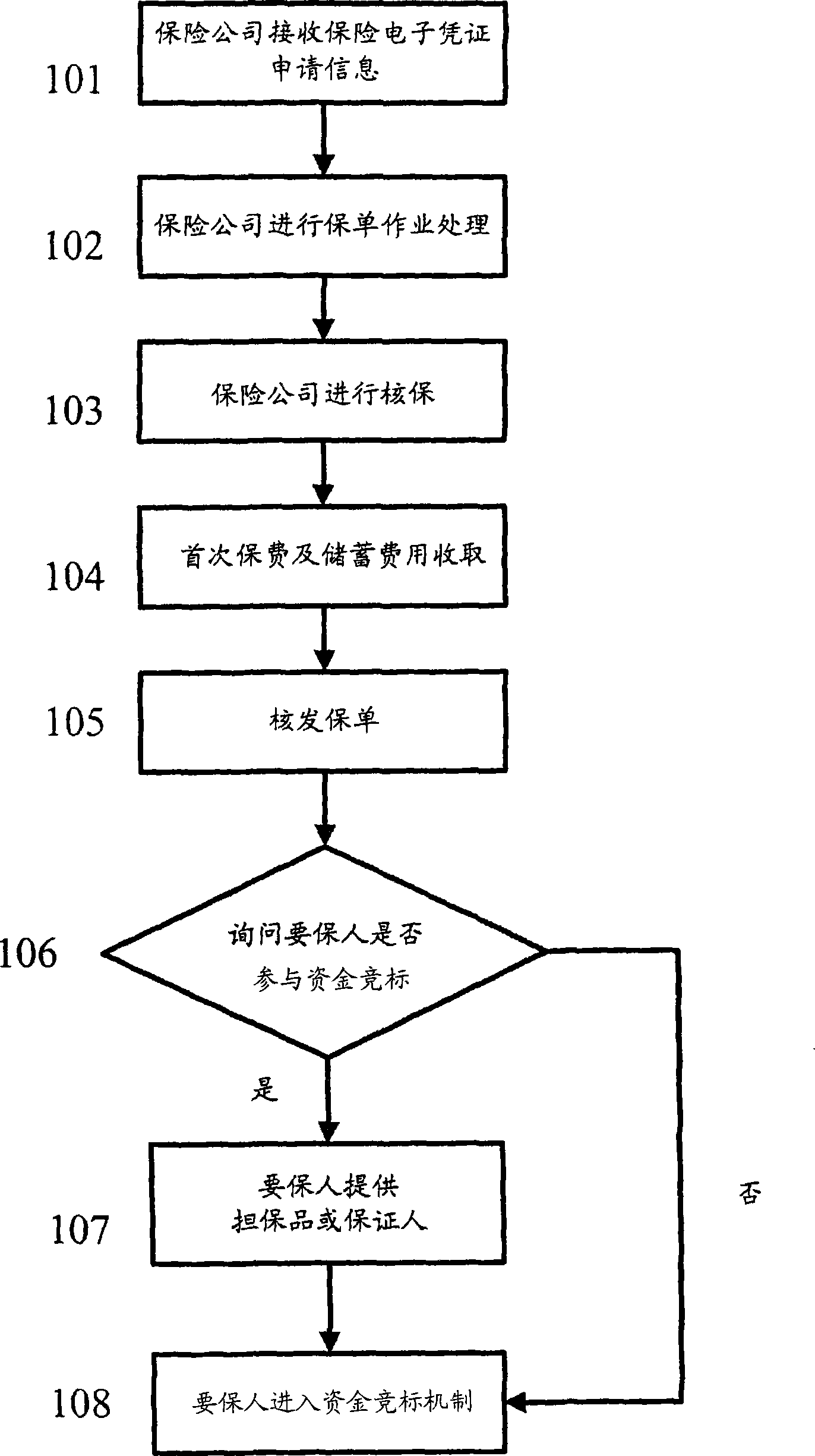

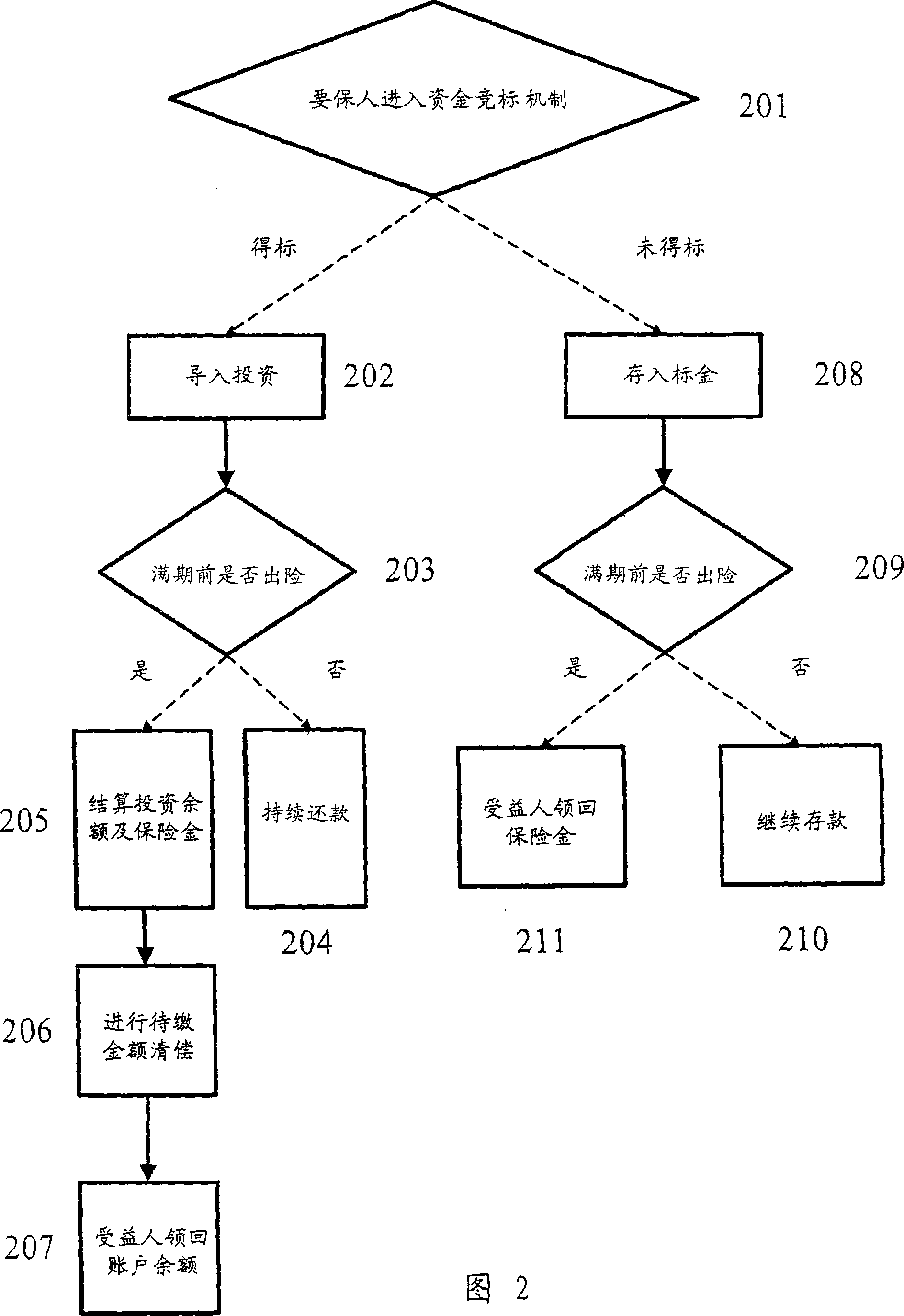

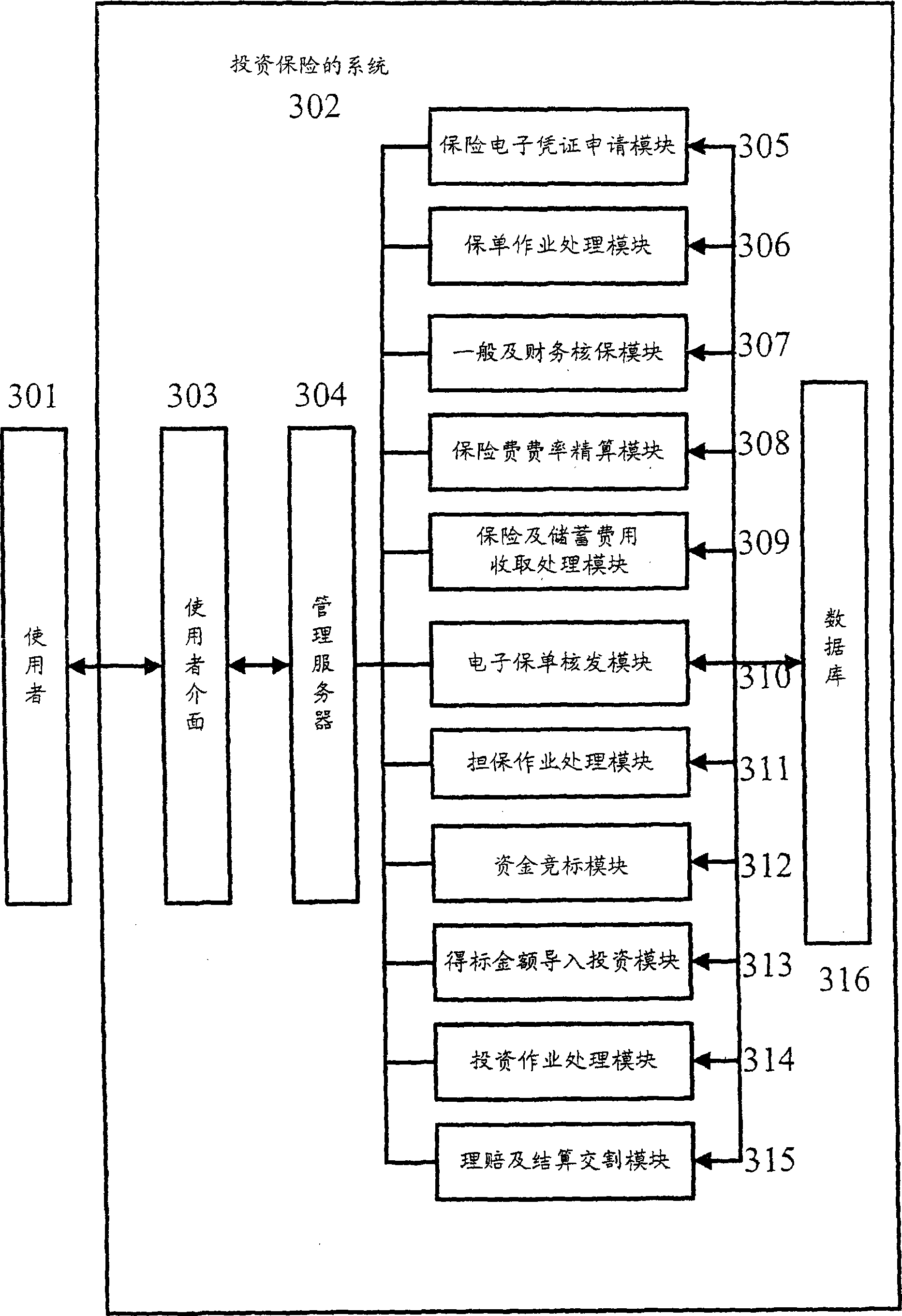

Insurance investing method and system

InactiveCN101425168AChange business modelInterest rate risk resolutionFinanceE-commerceOperation mode

The invention relates to a system and a method for insurance investment, which are applied to the insurance field of financial e-commerce. The invention aims to provide a new capital operation mode of investment type insurance, so that a consumer can freely select credit expansion or investment reward improvement or zero-risk saving, and the insurance industry can be free from interest risks. The system for insurance investment is taken as the a main part of operation, so an insurance company can leap out of the frame of making capital operation reward but taking interest risks and turns to eliminate the interest risks by collecting commission charge under the operation of a capital bidding mechanism; and an insurant can expand credit in the course of insurance to improve the investment income and strengthen the insurance guarantee.

Owner:SHACOM COM

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com