Insurance investing method and system

A technology of insurance contracts and funds, applied in the insurance field of financial e-commerce, can solve problems such as customer losses, customers' inability to save and invest, and the inability to effectively eliminate interest rate risks in the insurance industry, so as to achieve the effect of expanding credit and solving interest rate risks

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

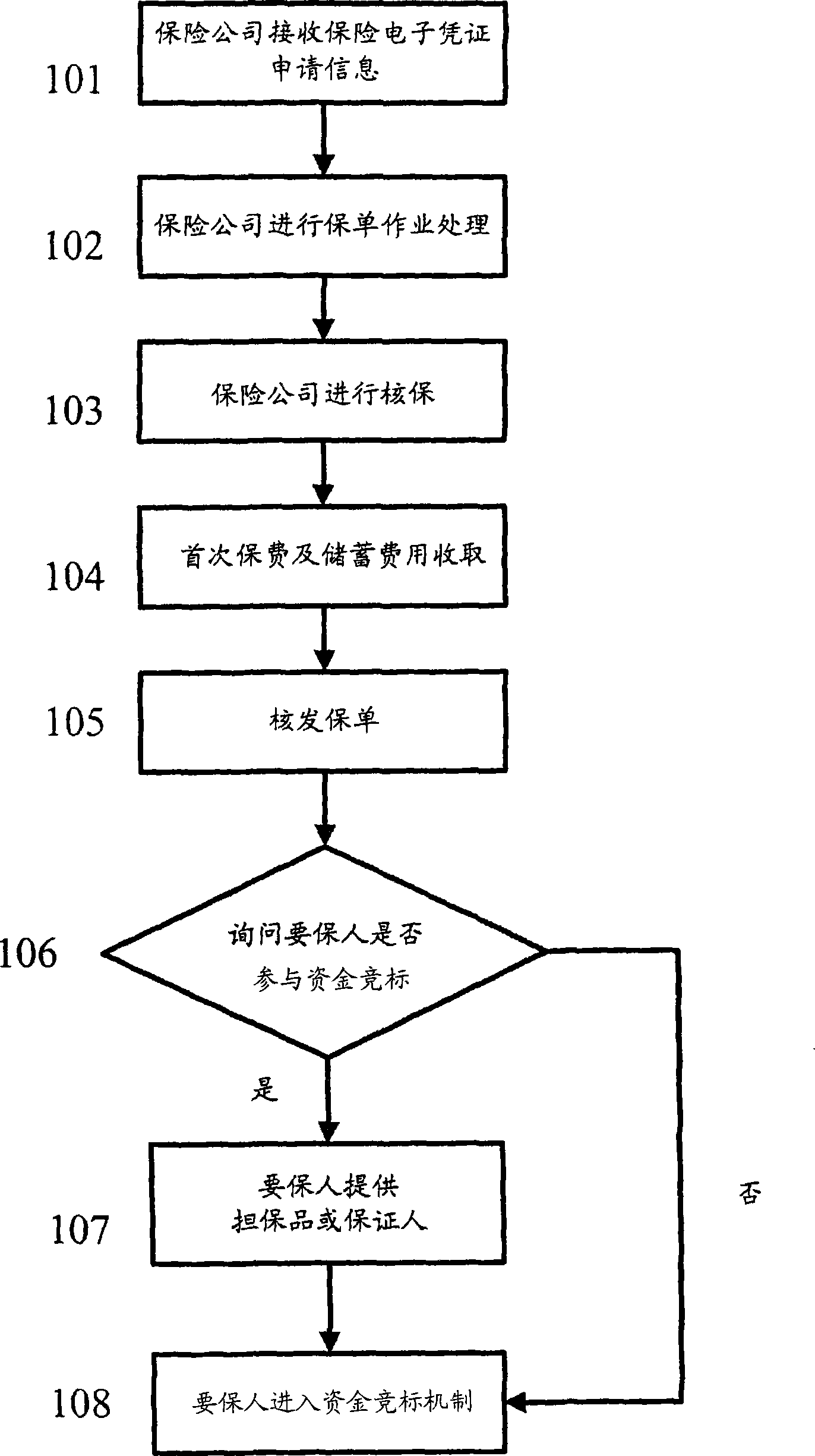

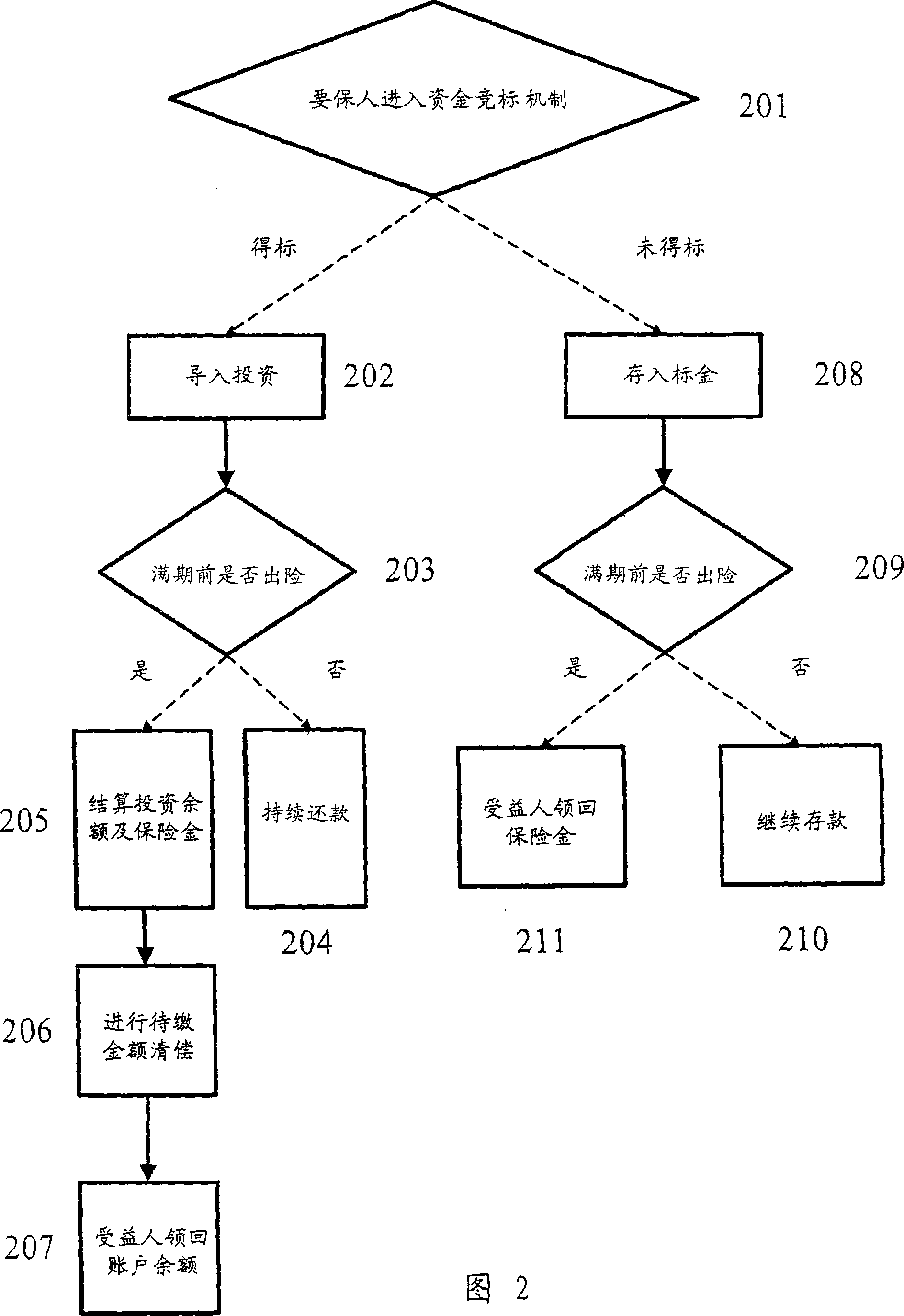

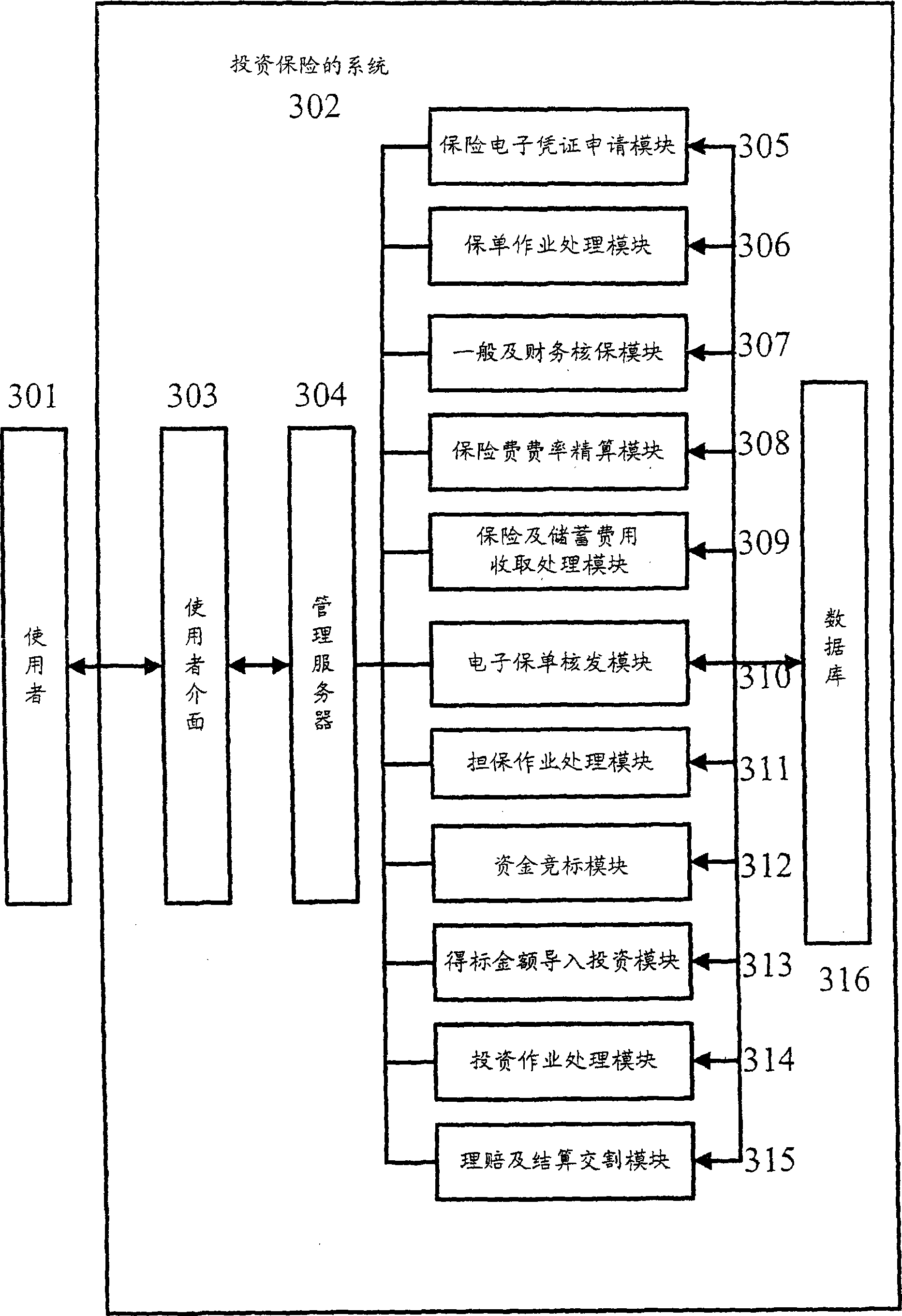

Method used

Image

Examples

Embodiment 1

[0095] Li Jun took insurance-related courses in college, so he deeply understands the importance of insurance for himself and his family. After graduating from university and working, Li Jun actively searched for insurance policies that met his financial ability and protection needs. However, although Li Jun knew the necessity of buying insurance, since his monthly salary was only 32,000 yuan, Li Jun still had to carefully calculate the premium ; Although the insurance premiums for pure protection policies are relatively cheap, if you are in good health and safe, you will never be able to get back the premiums after you pay them. , the premium for each period will be a heavy burden; if you choose an investment policy, the rate of return of the connected investment target is either too volatile or too low for the sake of capital and interest protection. Just when I was in distress, I saw a news about a new insurance product. The content roughly stated that a new product called ...

Embodiment 2

[0099] Zhang Jun was Li Jun's immediate supervisor. After Li Jun told him about the characteristics of "investment insurance", he purchased the ten-year death insurance of this product, with an insured amount of 3,000,000 yuan. Zhang Jun chose ten-year death insurance as the protection item. , the premium is paid monthly, and the investment project of the policy is connected to a ten-year period. Monthly payment, the unit amount is 20,000 yuan, and the general fund is 2,400,000 yuan. Since Zhang Jun chooses pure savings, he does not participate in the platform Bidding, therefore no need to provide collateral to the insurance company.

[0100] When Zhang Jun paid the insurance premium and savings for the 61st month, the company he worked for announced its dissolution. I tried my best to pay insurance premiums and savings until the sixty-sixth month, but at this point, Zhang Jun finally realized that the knowledge and skills he is good at have been classified as sunset industrie...

Embodiment 3

[0102] Fang Jun is a friend of Zhang Jun's university club. He followed Zhang Jun insured "investment insurance". Fang Jun chose 12-year death insurance with an insured amount of 4,000,000 yuan. Two-year period, monthly payment, unit amount of 20,000 yuan, general fund of 2,880,000 yuan for a fund bidding combination. Since Fang Jun is a high-tech research and development personnel and has no time to participate in fund bidding, he chooses pure savings. Suppose the bidder pays 2,000 yuan Yuan won the bid, Fang Jun only needs to pay 18,000 Yuan and earn 2,000 Yuan in interest. In addition, Fang Jun does not participate in platform bidding and therefore does not need to provide collateral.

[0103] Fang Jun has a stable job and a smooth life, so the annual insurance premium and monthly savings are paid on time. By the 143rd month, Fang Jun paid the last savings for "investment insurance". The policy expired at the 144th month, and Fang Jun successfully received the due savings o...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com