Patents

Literature

320 results about "Risk model" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Model risk is a type of risk that occurs when a financial model is used to measure quantitative information such as a firm's market risks or value transactions, and the model fails or performs inadequately and leads to adverse outcomes for the firm.

Design of computer based risk and safety management system of complex production and multifunctional process facilities-application to fpso's

InactiveUS20120317058A1Strong robust attributeStrong robust attributesDigital computer detailsFuzzy logic based systemsProcess systemsNerve network

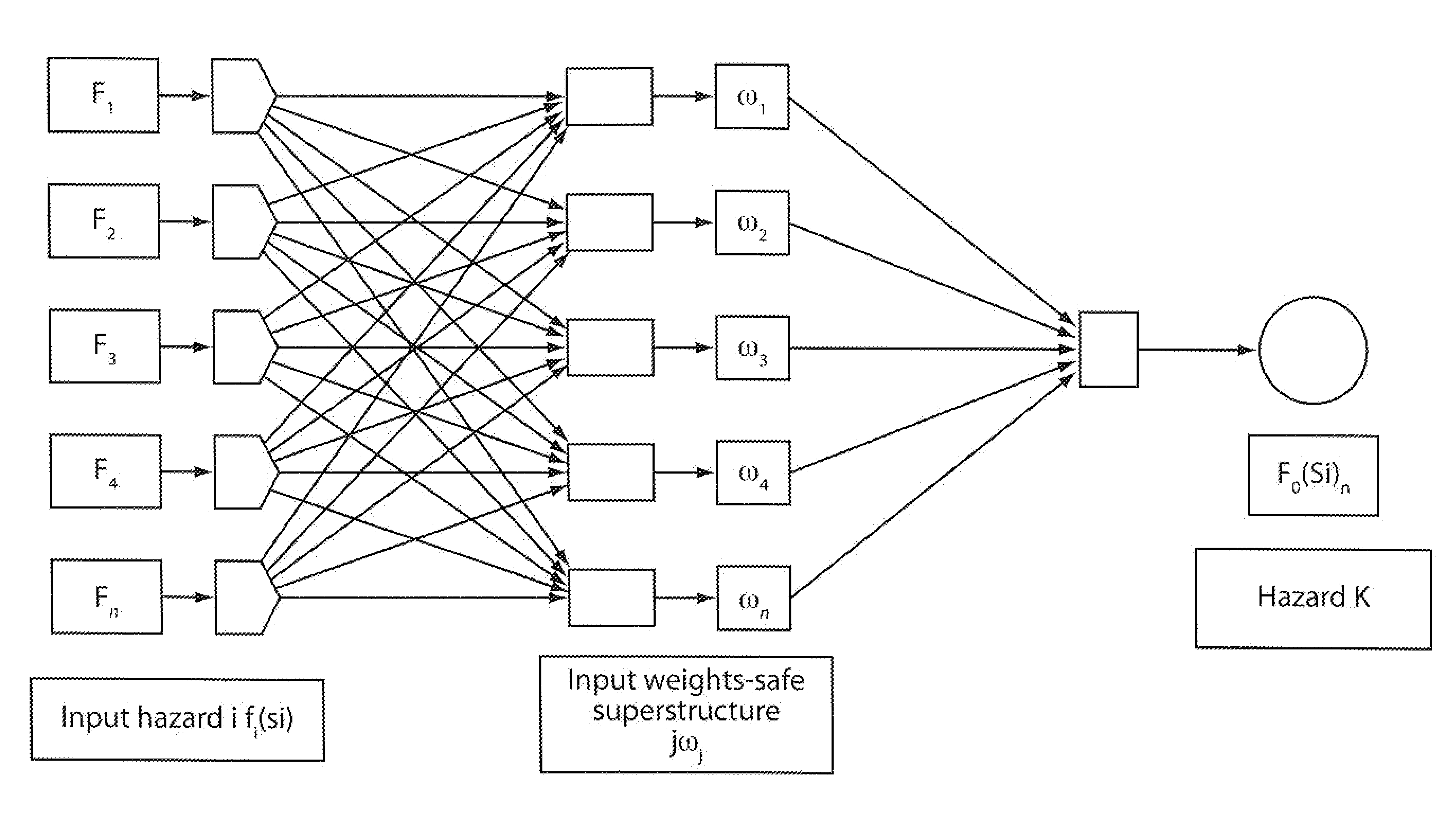

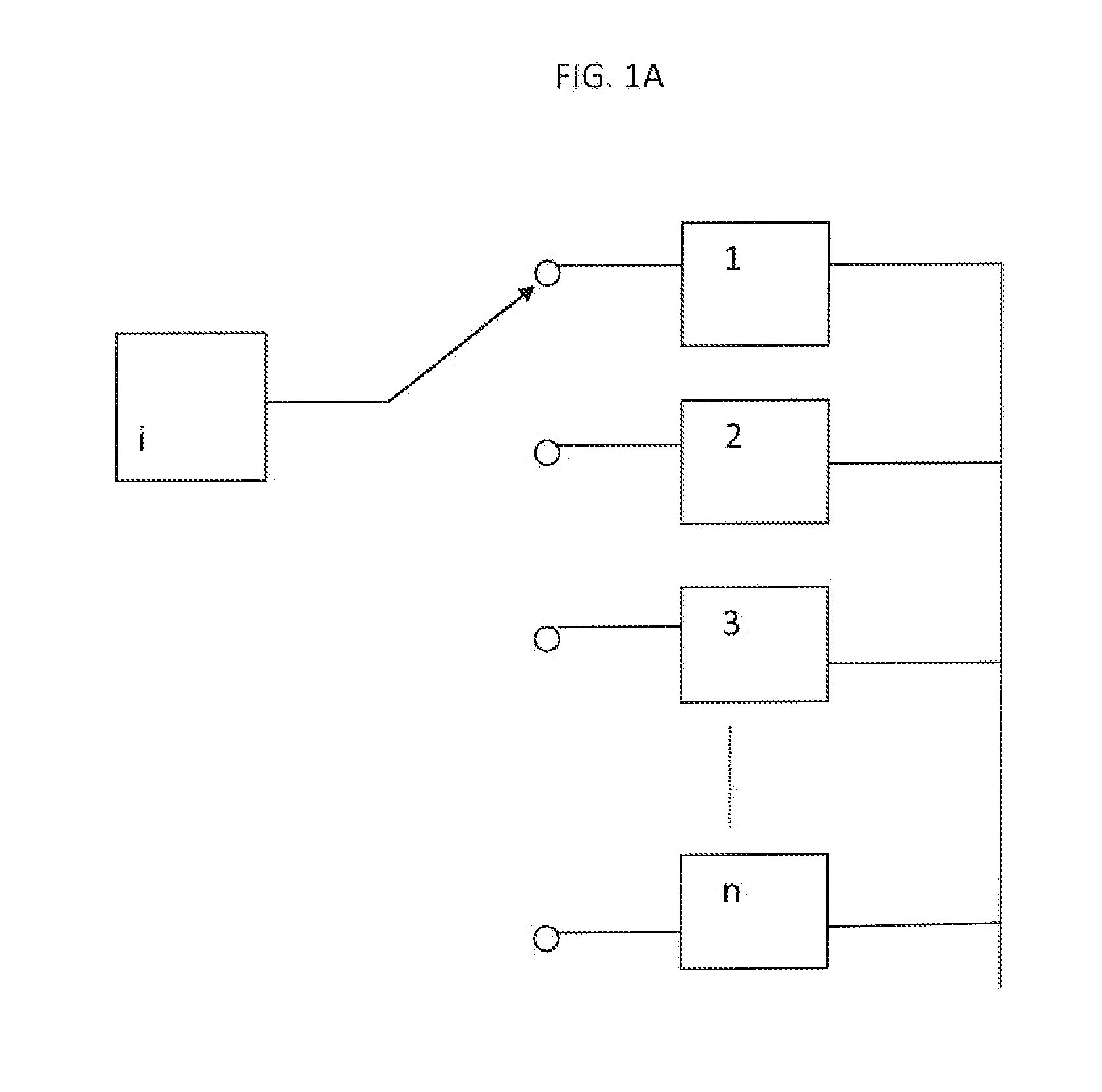

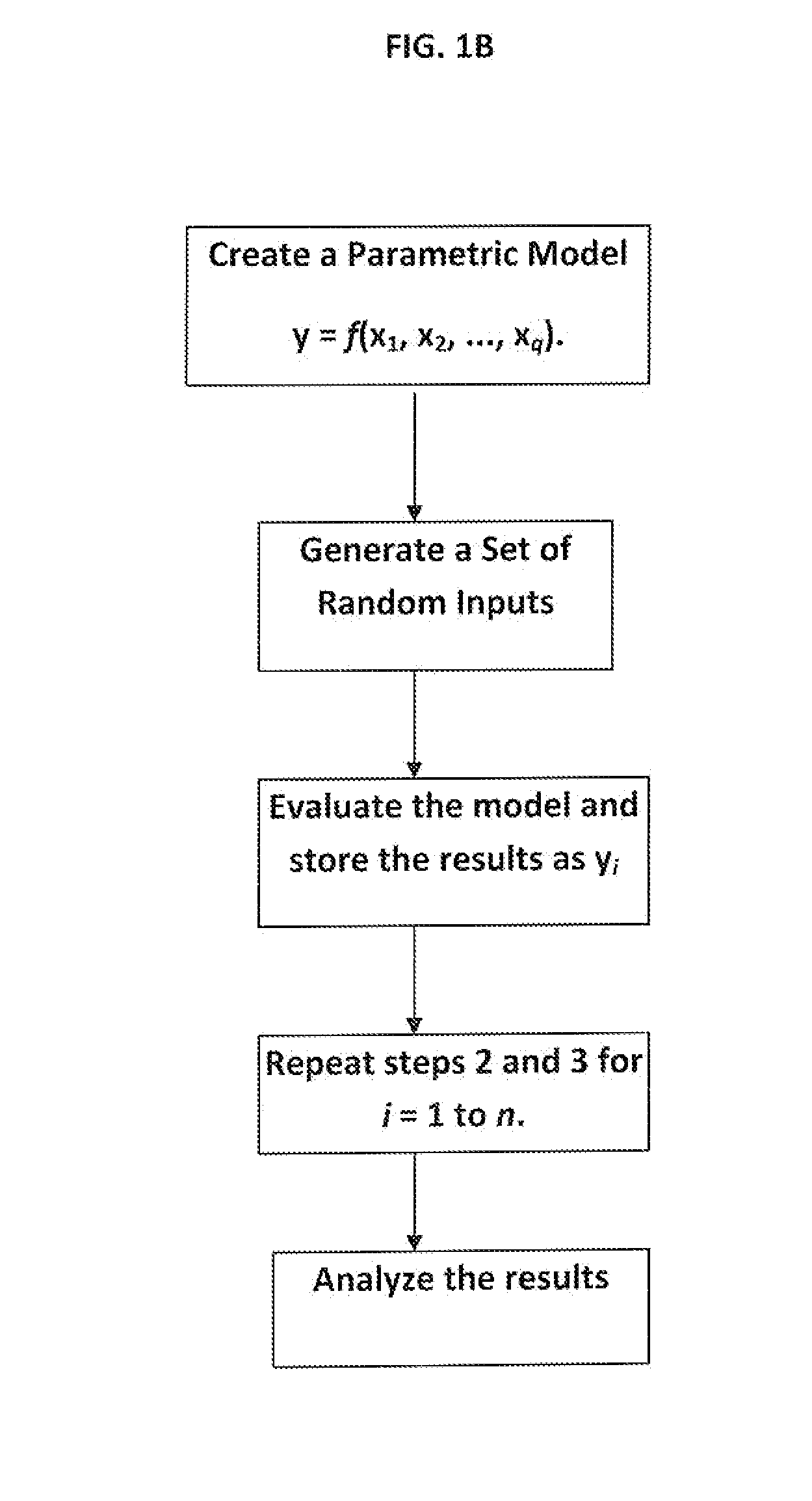

A method for predicting risk and designing safety management systems of complex production and process systems which has been applied to an FPSO System operating in deep waters. The methods for the design were derived from the inclusion of a weight index in a fuzzy class belief variable in the risk model to assign the relative numerical value or importance a safety device or system has contain a risk hazards within the barrier. The weights index distributes the relative importance of risk events in series or parallel in several interactive risk and safety device systems. The fault tree, the FMECA and the Bow Tie now contains weights in fizzy belief class for implementing safety management programs critical to the process systems. The techniques uses the results of neural networks derived from fuzzy belief systems of weight index to implement the safety design systems thereby limiting use of experienced procedures and benchmarks. The weight index incorporate Safety Factors sets SFri {0, 0.1, 0.2 . . . 1}, and Markov Chain Network to allow the possibility of evaluating the impact of different risks or reliability of multifunctional systems in transient state process. The application of this technique and results of simulation to typical FPSO / Riser systems has been discussed in this invention.

Owner:ABHULIMEN KINGSLEY E

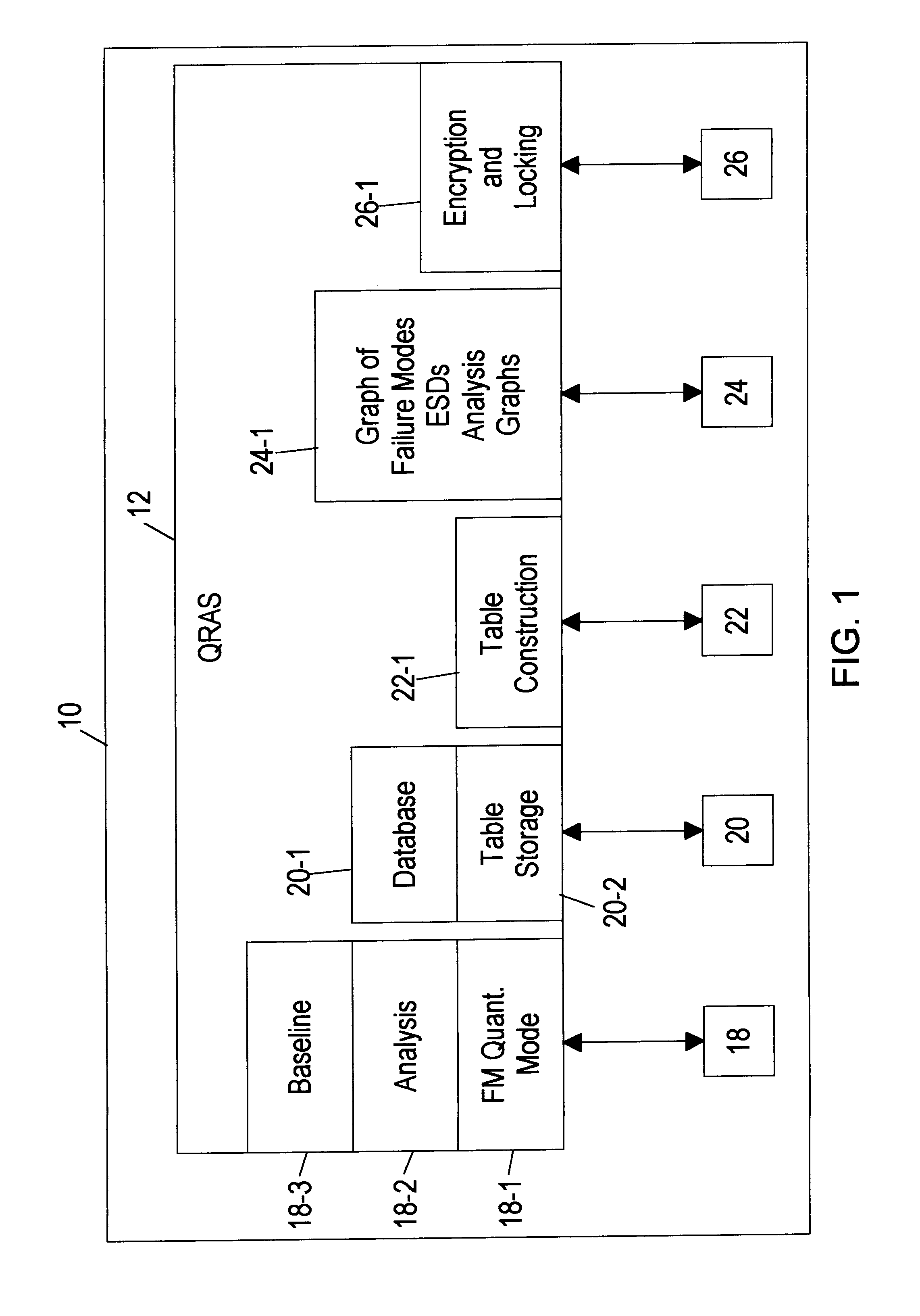

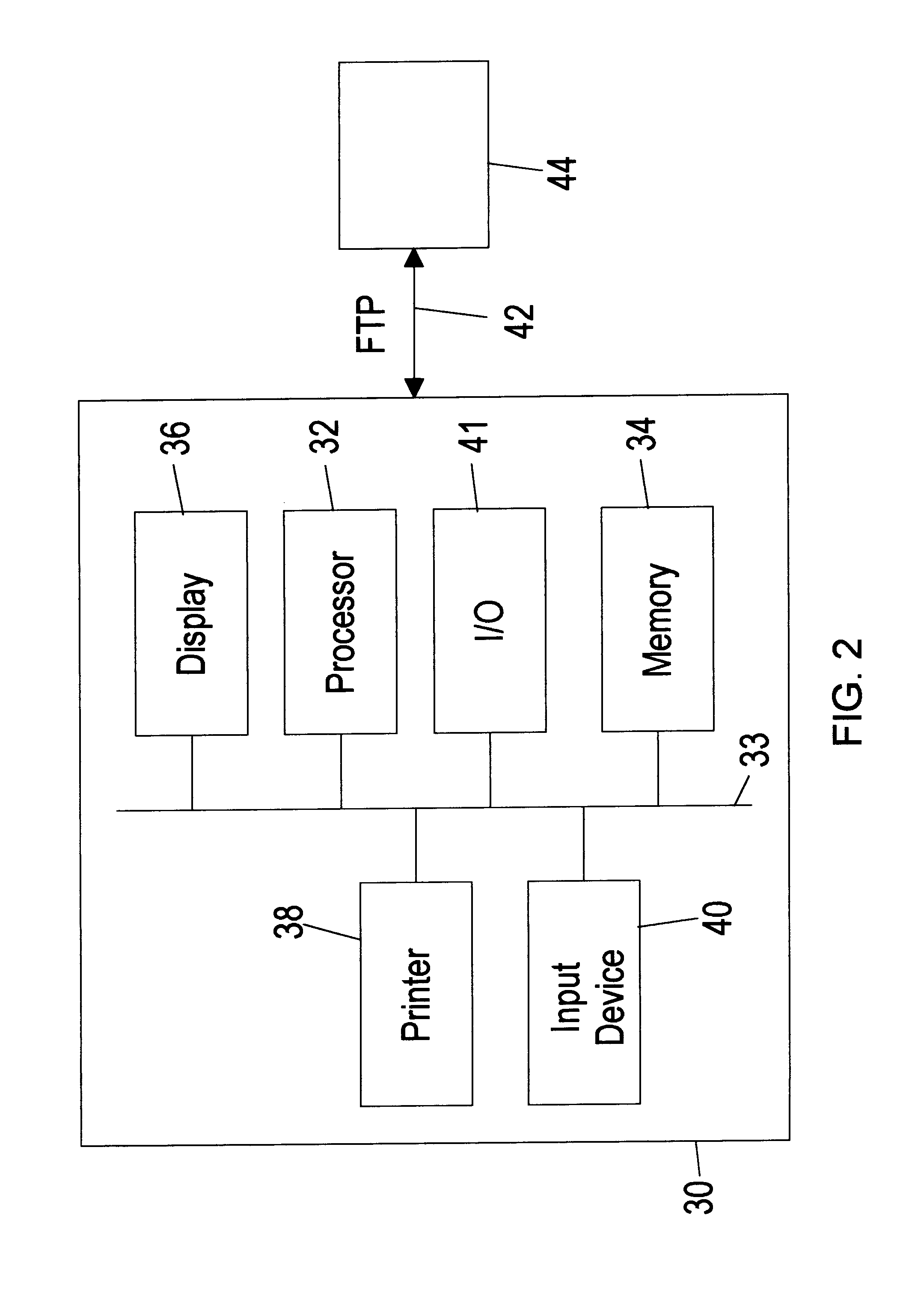

Quantitative risk assessment system (QRAS)

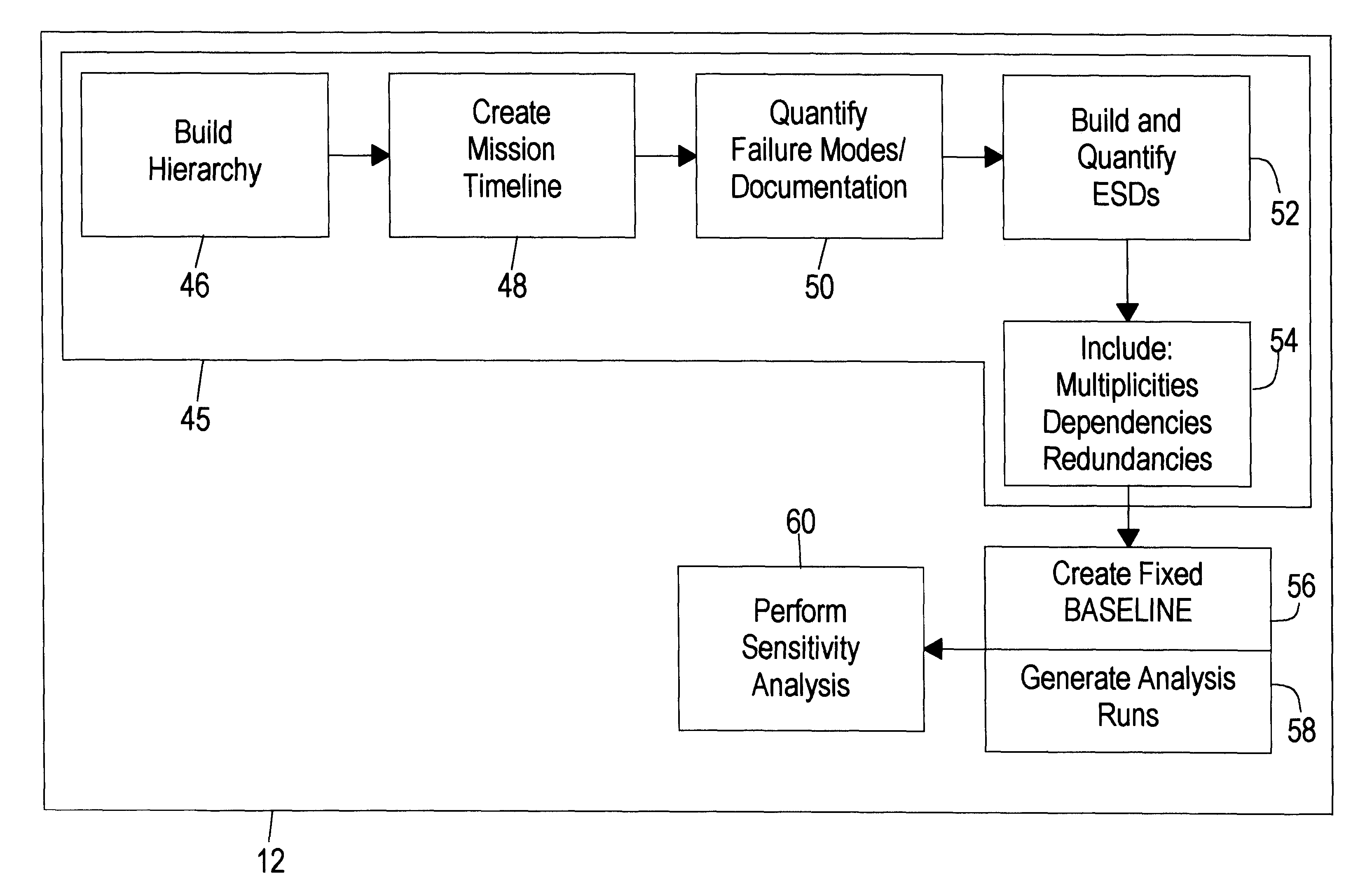

A quantitative risk assessment system (QRAS) builds a risk model of a system for which risk of failure is being assessed, then analyzes the risk of the system corresponding to the risk model. The QRAS performs sensitivity analysis of the risk model by altering fundamental components and quantifications built into the risk model, then re-analyzes the risk of the system using the modifications. More particularly, the risk model is built by building a hierarchy, creating a mission timeline, quantifying failure modes, and building / editing event sequence diagrams. Multiplicities, dependencies, and redundancies of the system are included in the risk model. For analysis runs, a fixed baseline is first constructed and stored. This baseline contains the lowest level scenarios, preserved in event tree structure. The analysis runs, at any level of the hierarchy and below, access this baseline for risk quantitative computation as well as ranking of particular risks. A standalone Tool Box capability exists, allowing the user to store application programs within QRAS.

Owner:NAT AERONAUTICS & SPACE ADMINISTATION U S GOVERNMENT AS REPRESENTED BY THE ADMINISTATOR +1

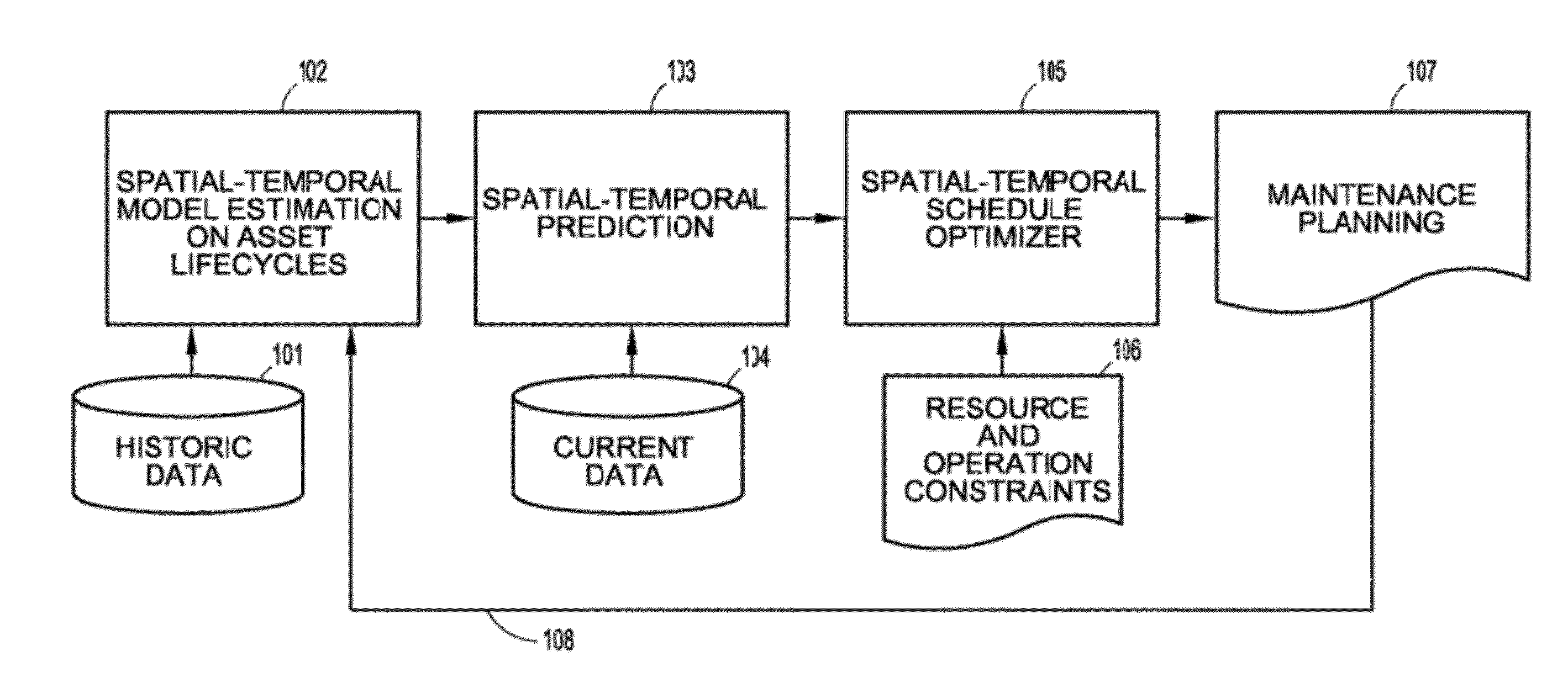

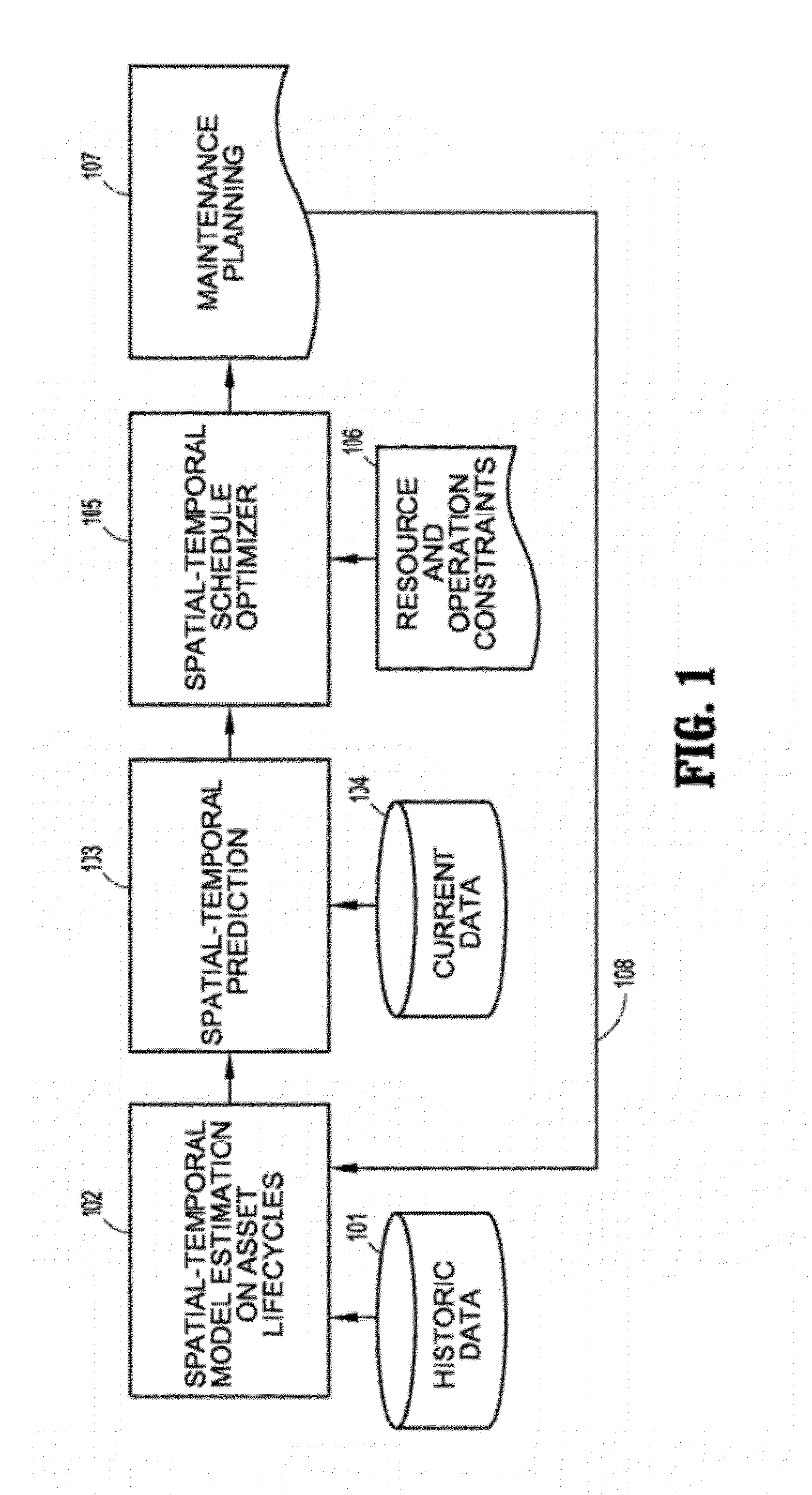

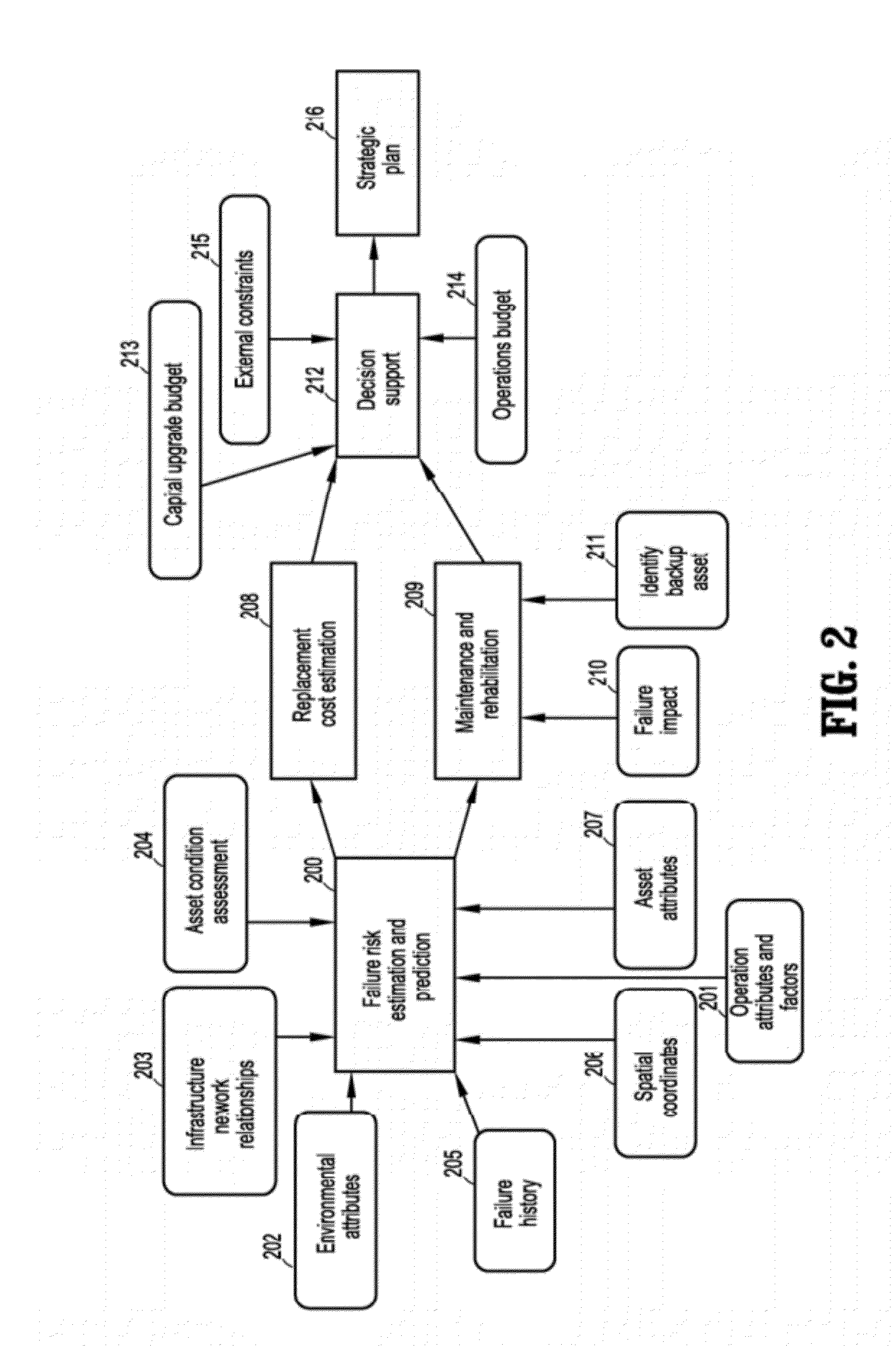

Spatial-Temporal Optimization of Physical Asset Maintenance

A method for determining a maintenance schedule of geographically dispersed physical assets includes receiving asset data including infrastructure relationships between the assets, modeling failure risk of the assets based on spatial, temporal and network relationships, and producing the maintenance schedule according to a combination of the risk model, asset data, maintenance, and external operation constraints. The maintenance schedule may be corrective and / or strategic.

Owner:IBM CORP

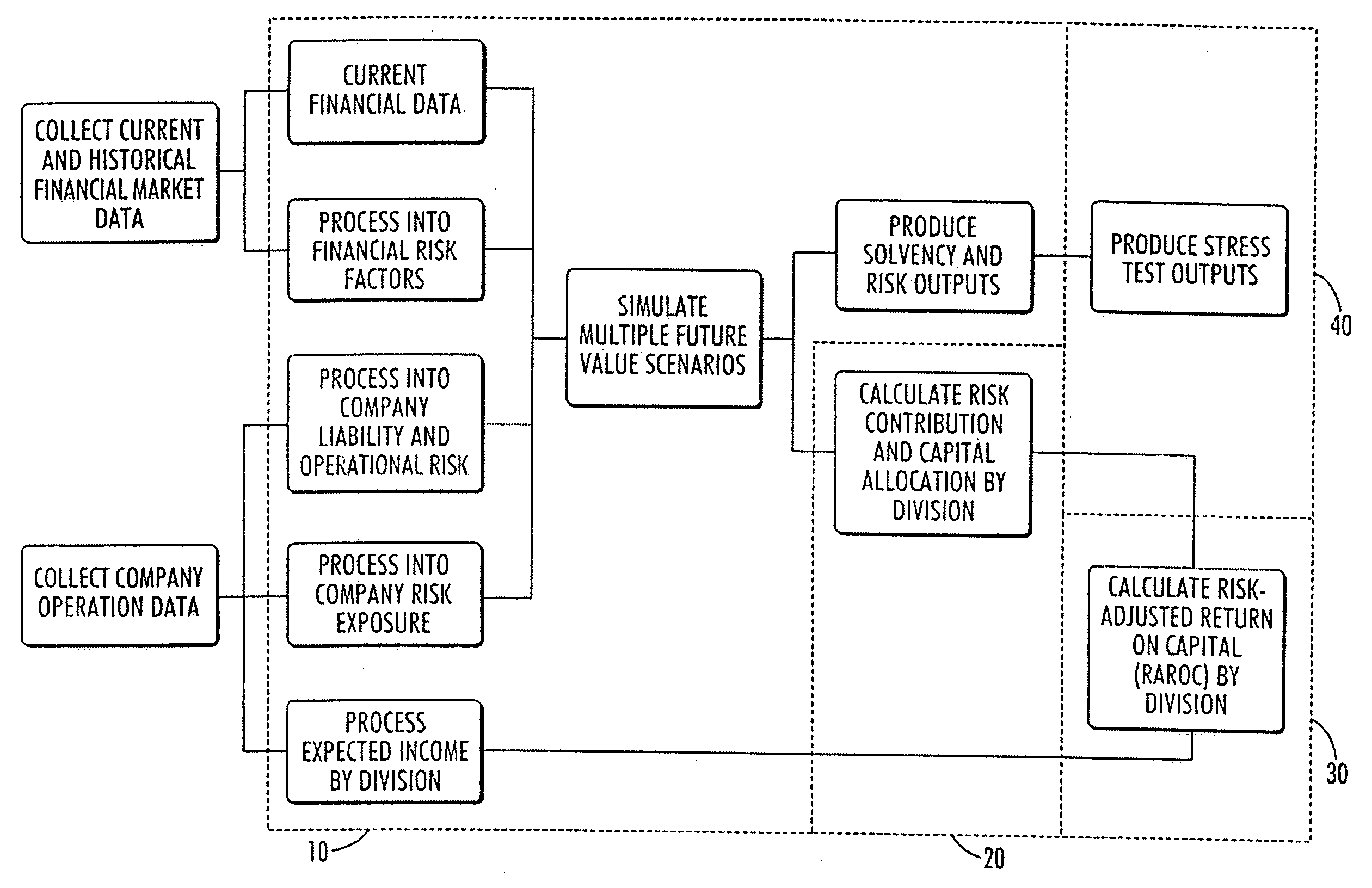

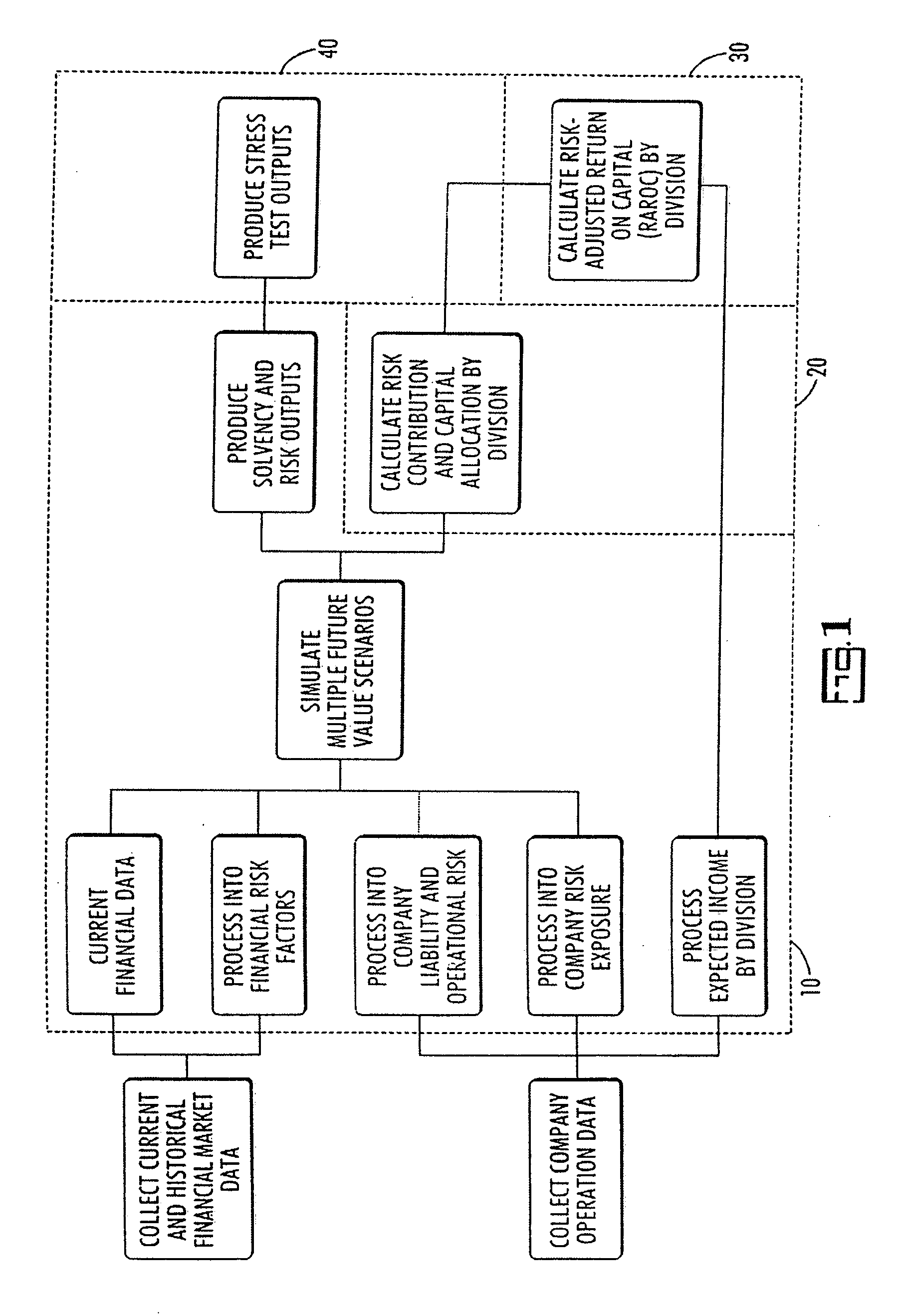

Business enterprise risk model and method

InactiveUS20050027645A1Solve low usageAccurate measurementFinanceSpecial data processing applicationsBusiness enterpriseRisk model

Owner:SEABURY ANALYTIC

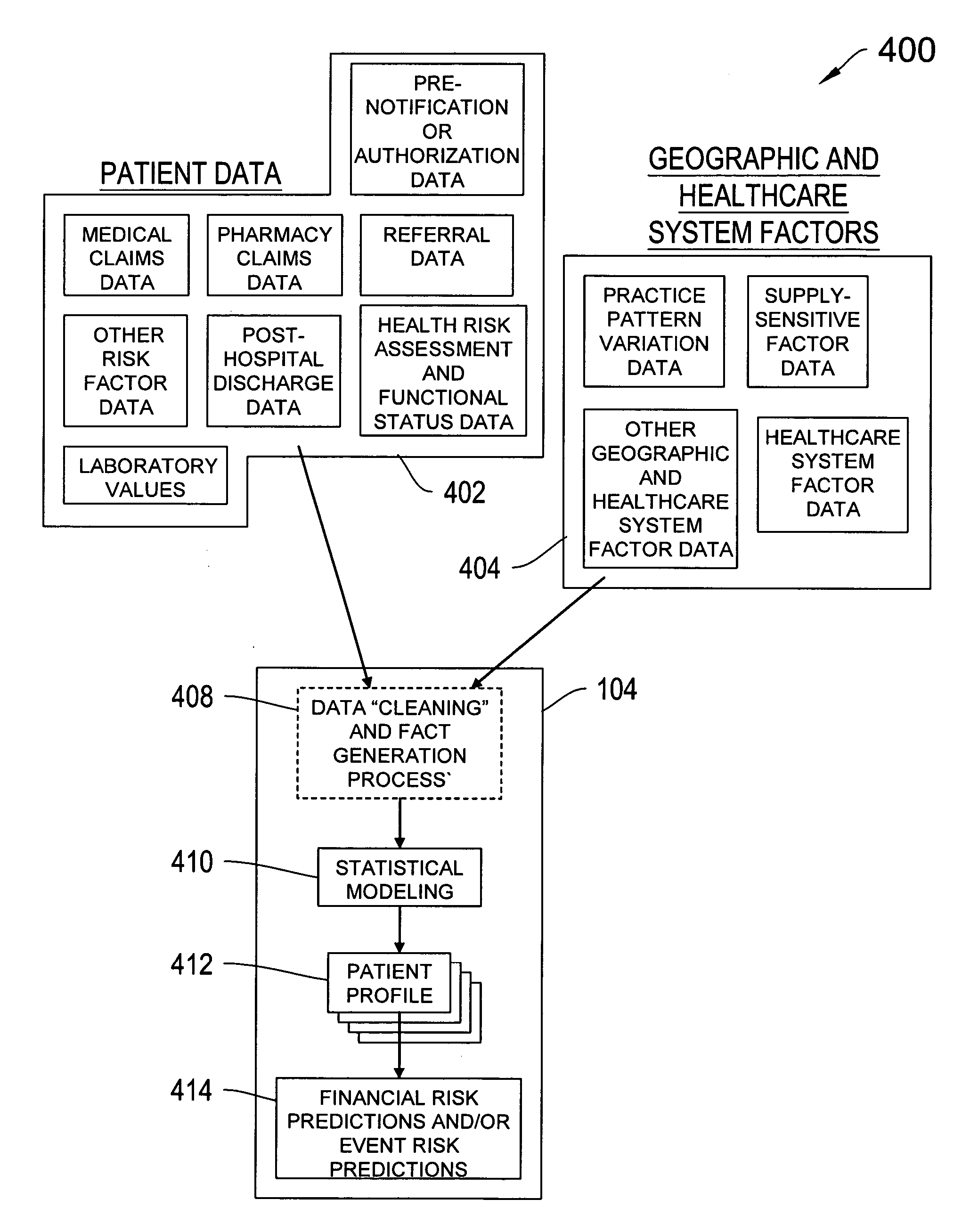

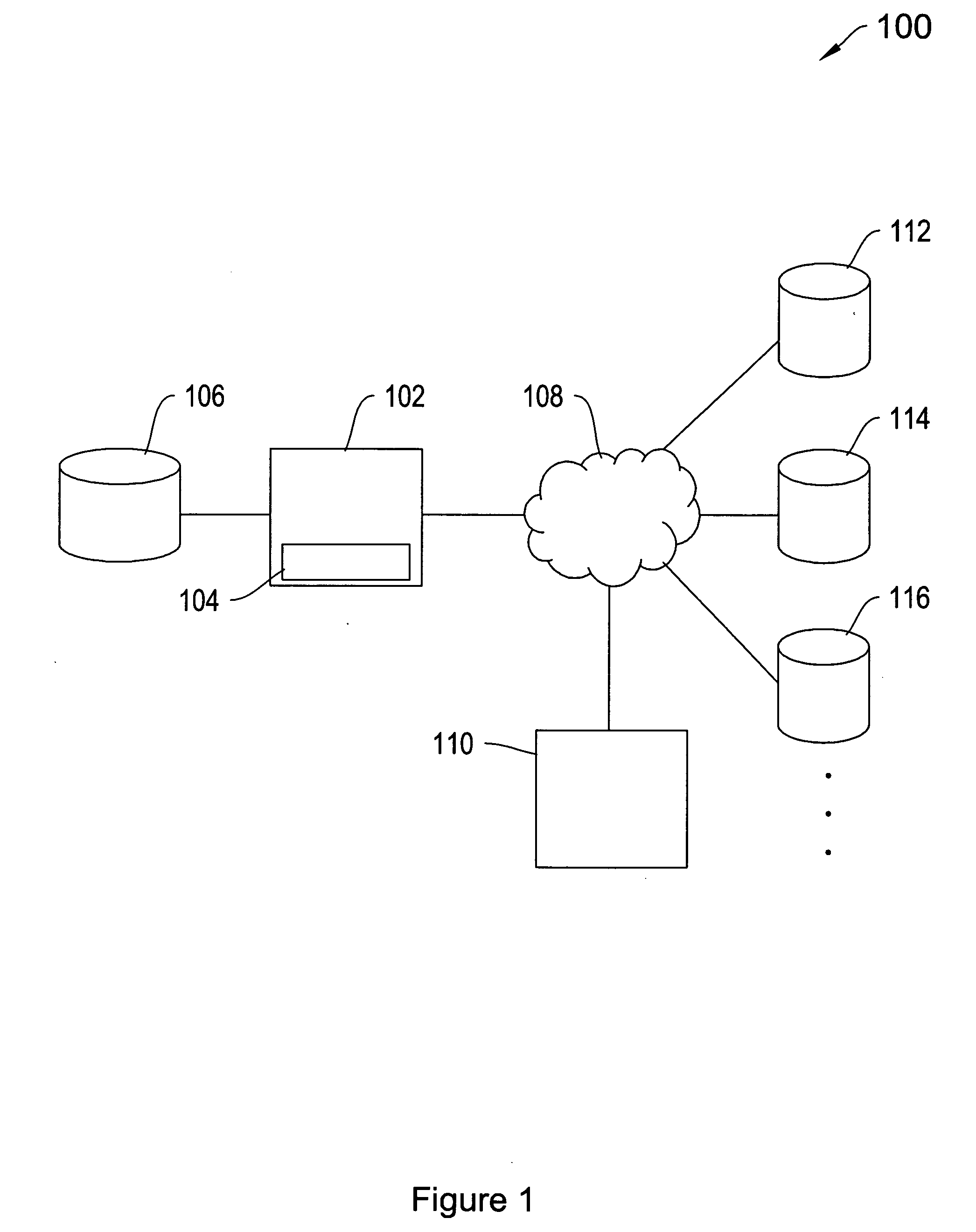

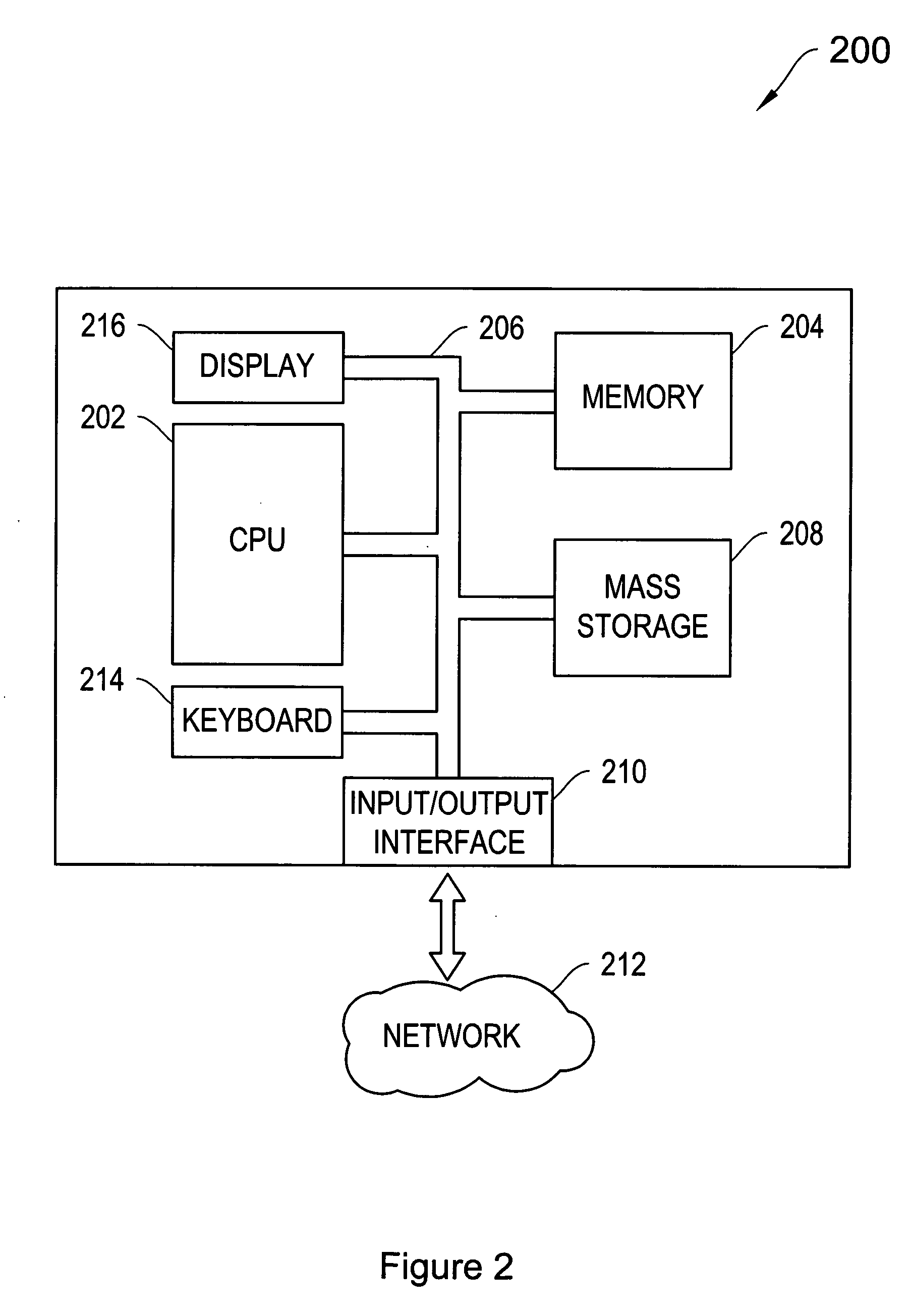

Systems and methods for predicting healthcare related financial risk

ActiveUS20060129428A1Reduce medical costsPrevent and mitigate occurrenceMedical simulationMedical data miningRisk levelRisk model

A system for predicting healthcare financial risk including the process of accessing patient data associated with one or more patents, accessing geographic and healthcare system data, filtering the patient data, geographic data, and healthcare system data into clean data, and applying a predictive risk model to the clean data to generate patient profile data and to identify a portion of the patients associated with a level of predicted financial risk.

Owner:HEALTH DIALOG SERVICES CORP

Total structural risk model

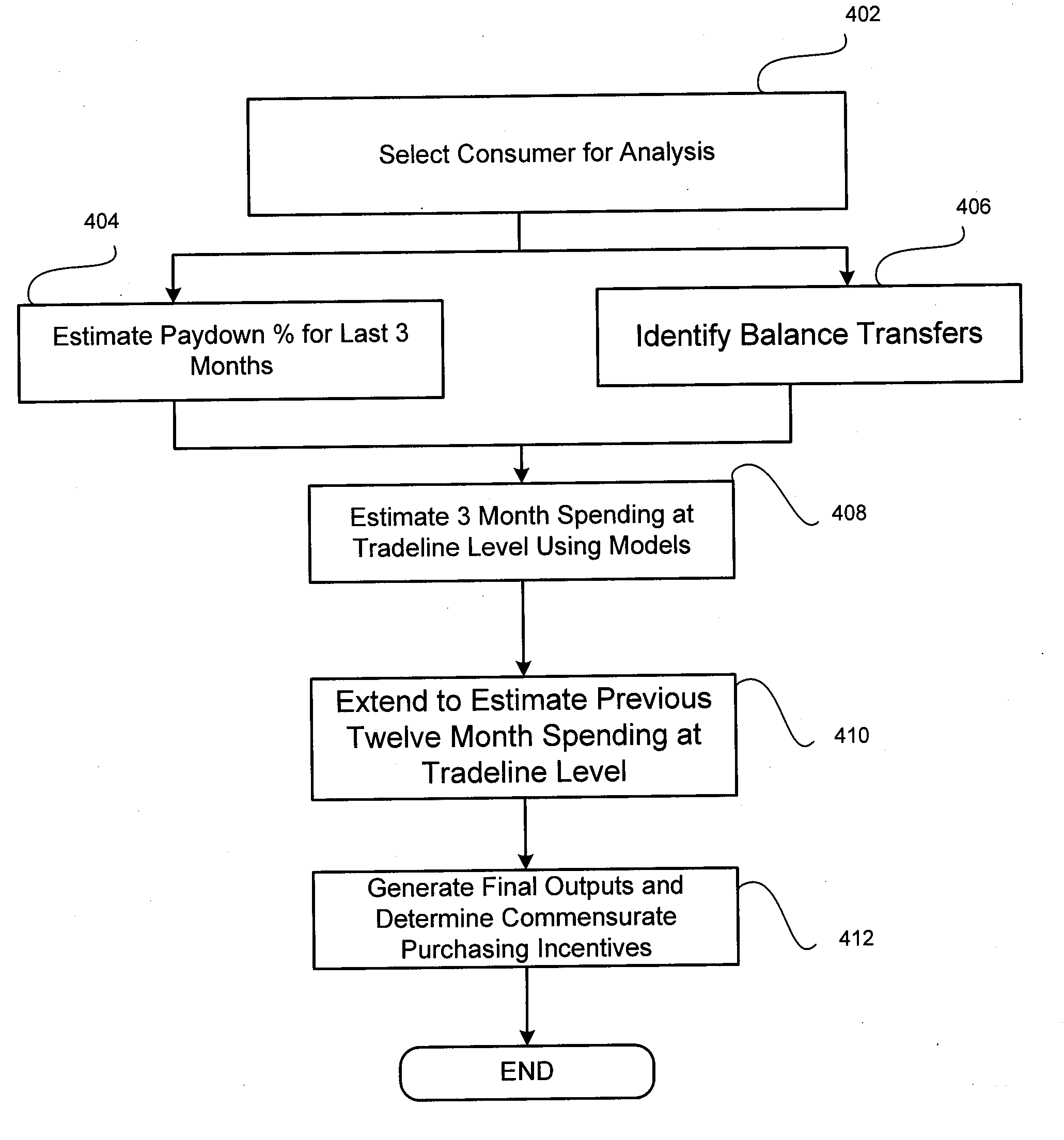

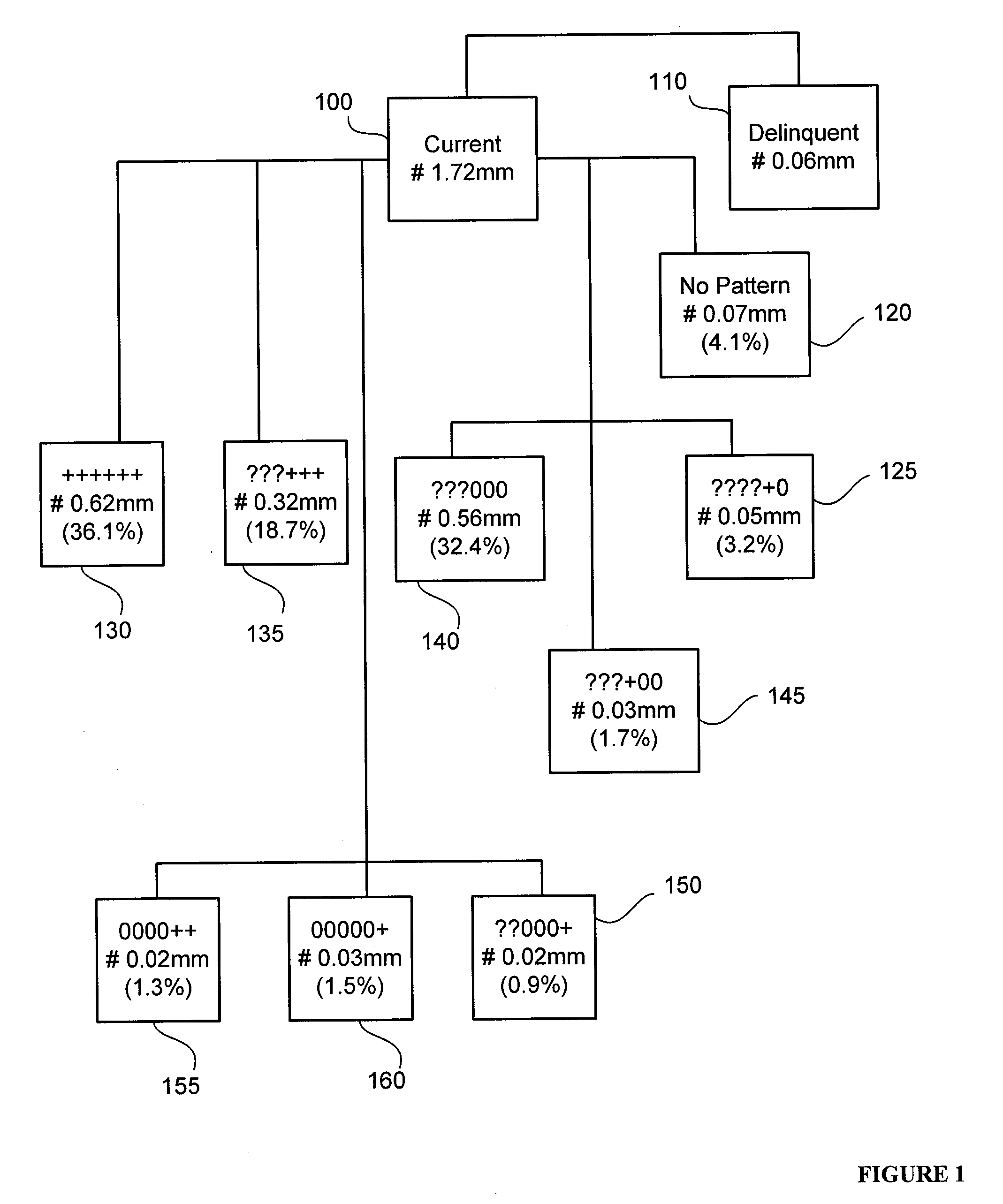

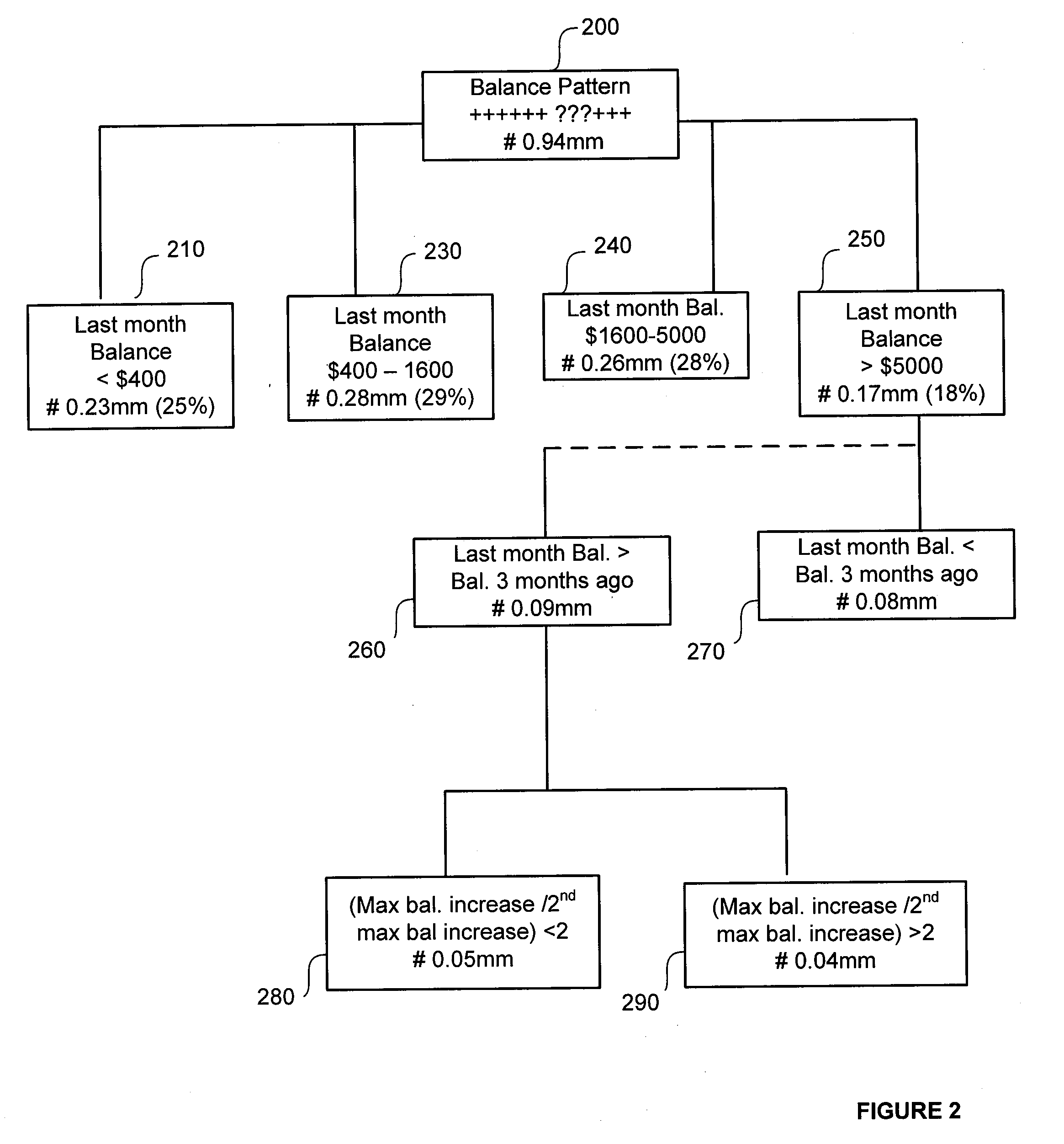

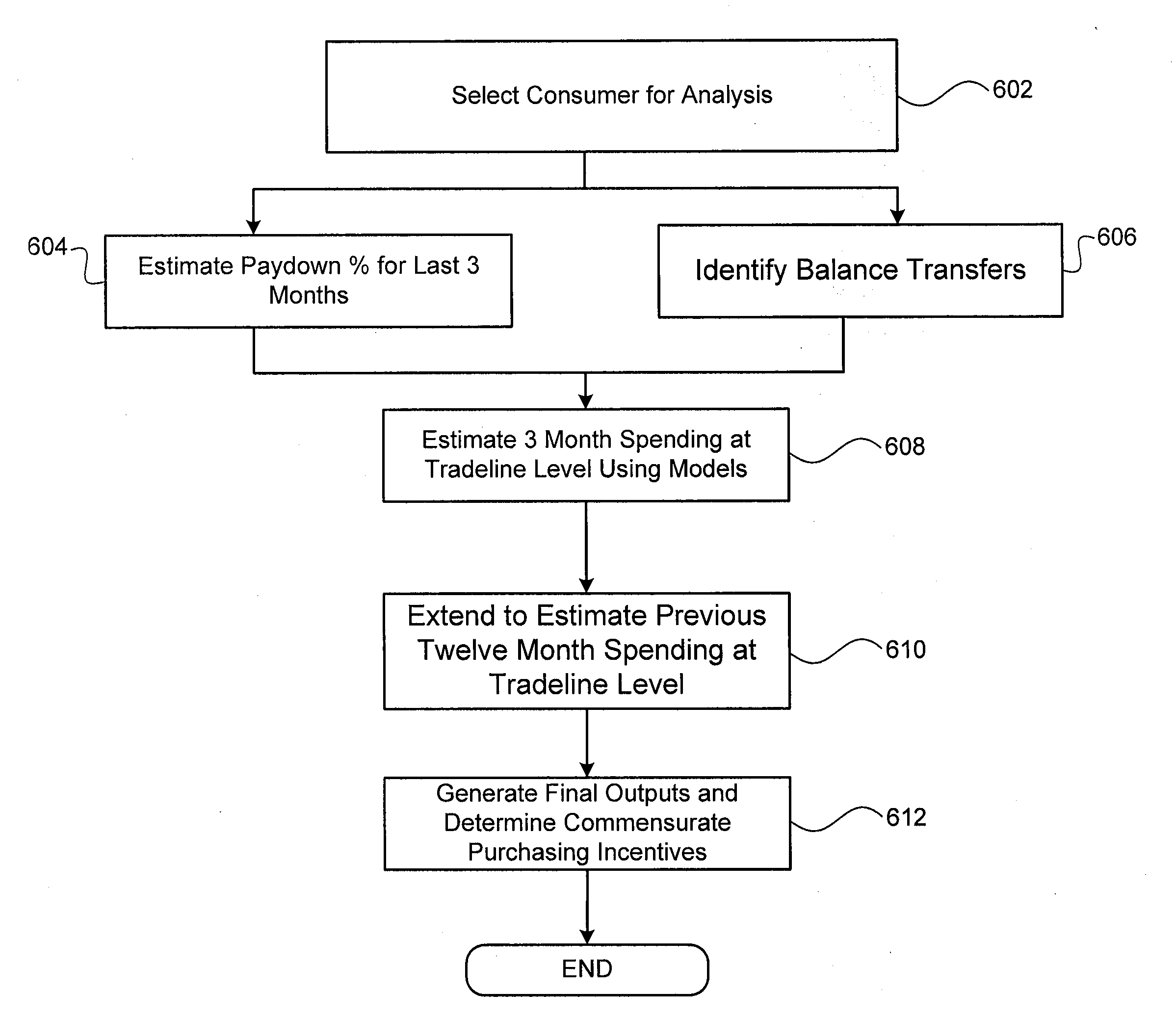

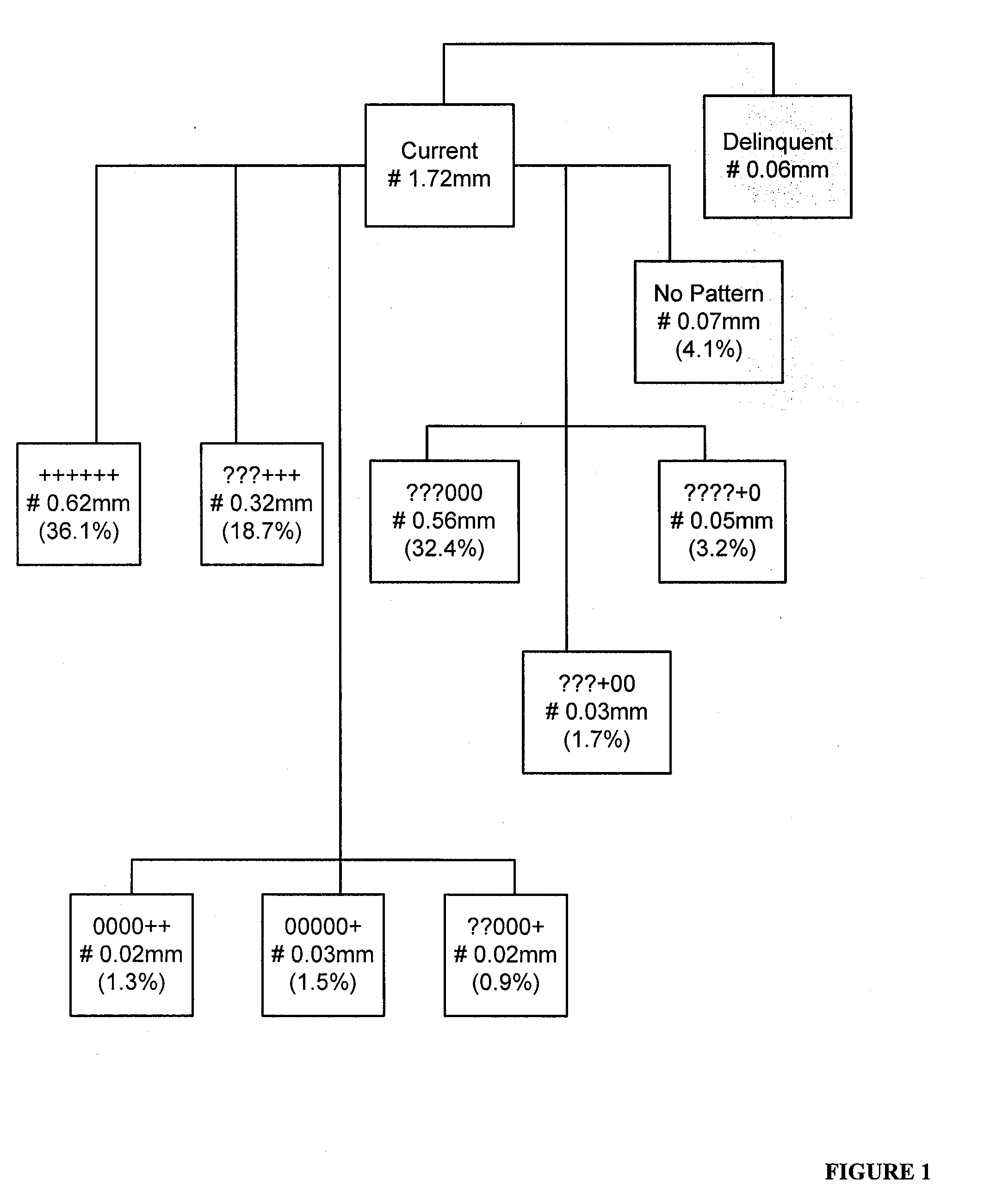

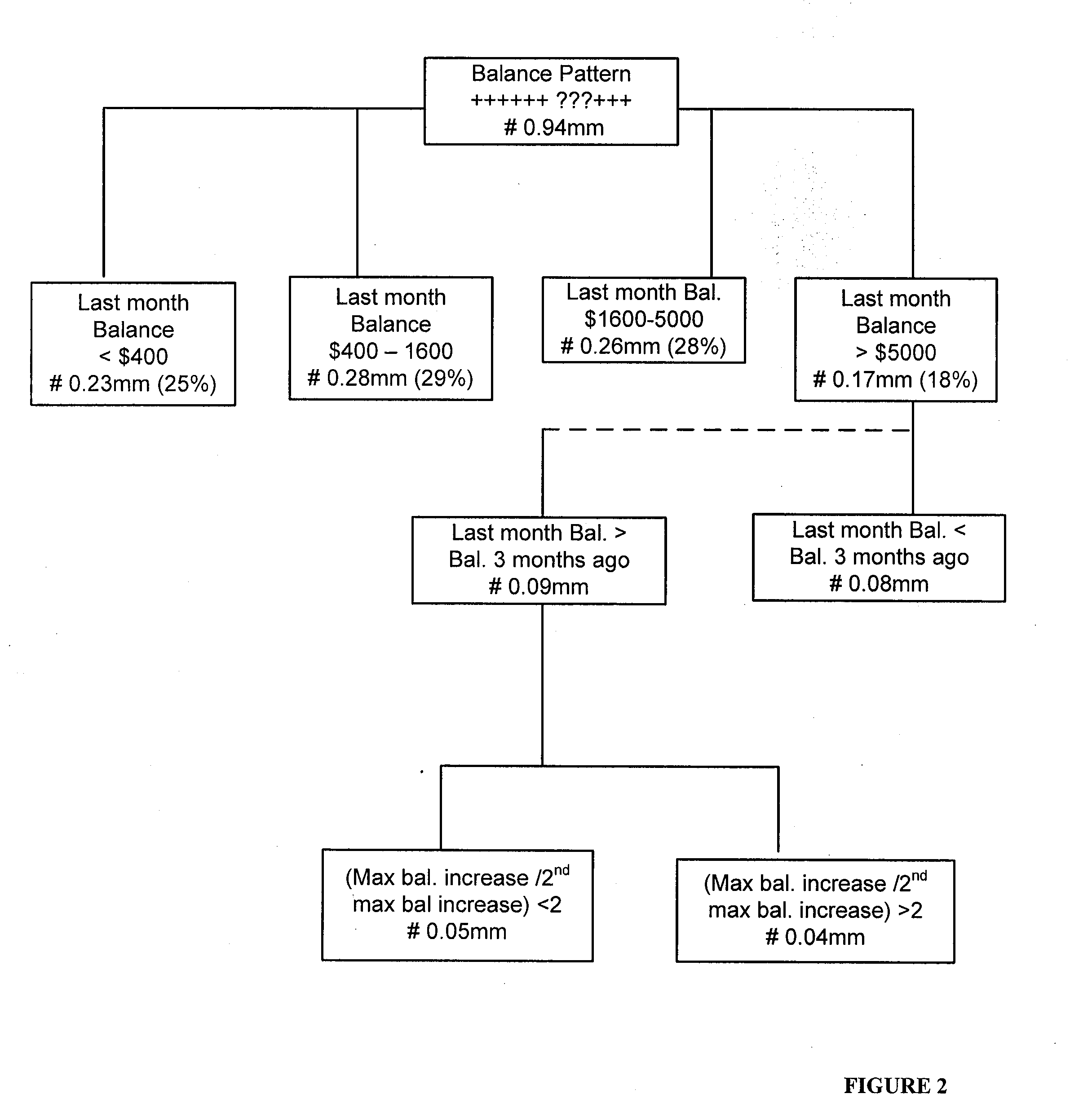

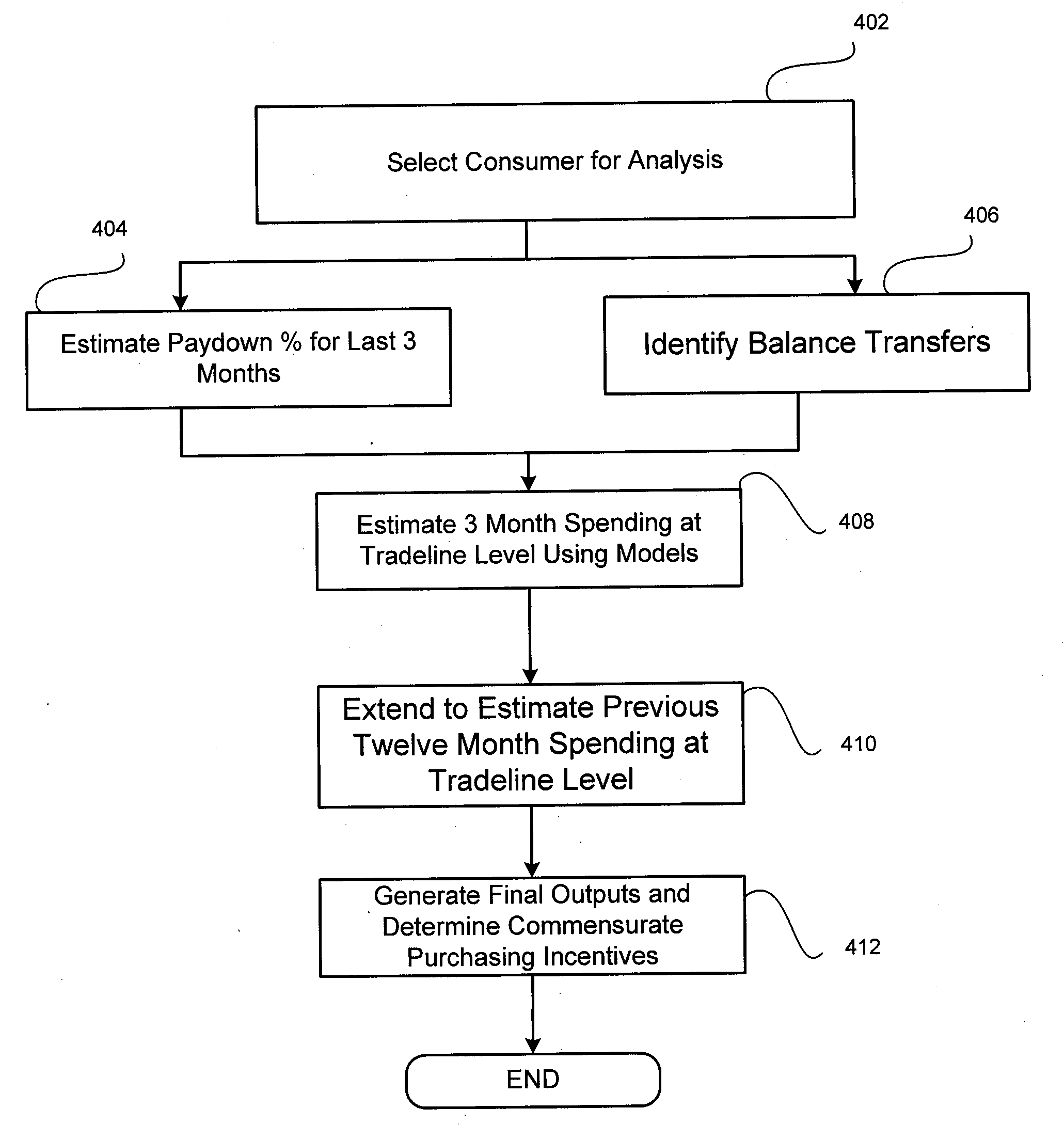

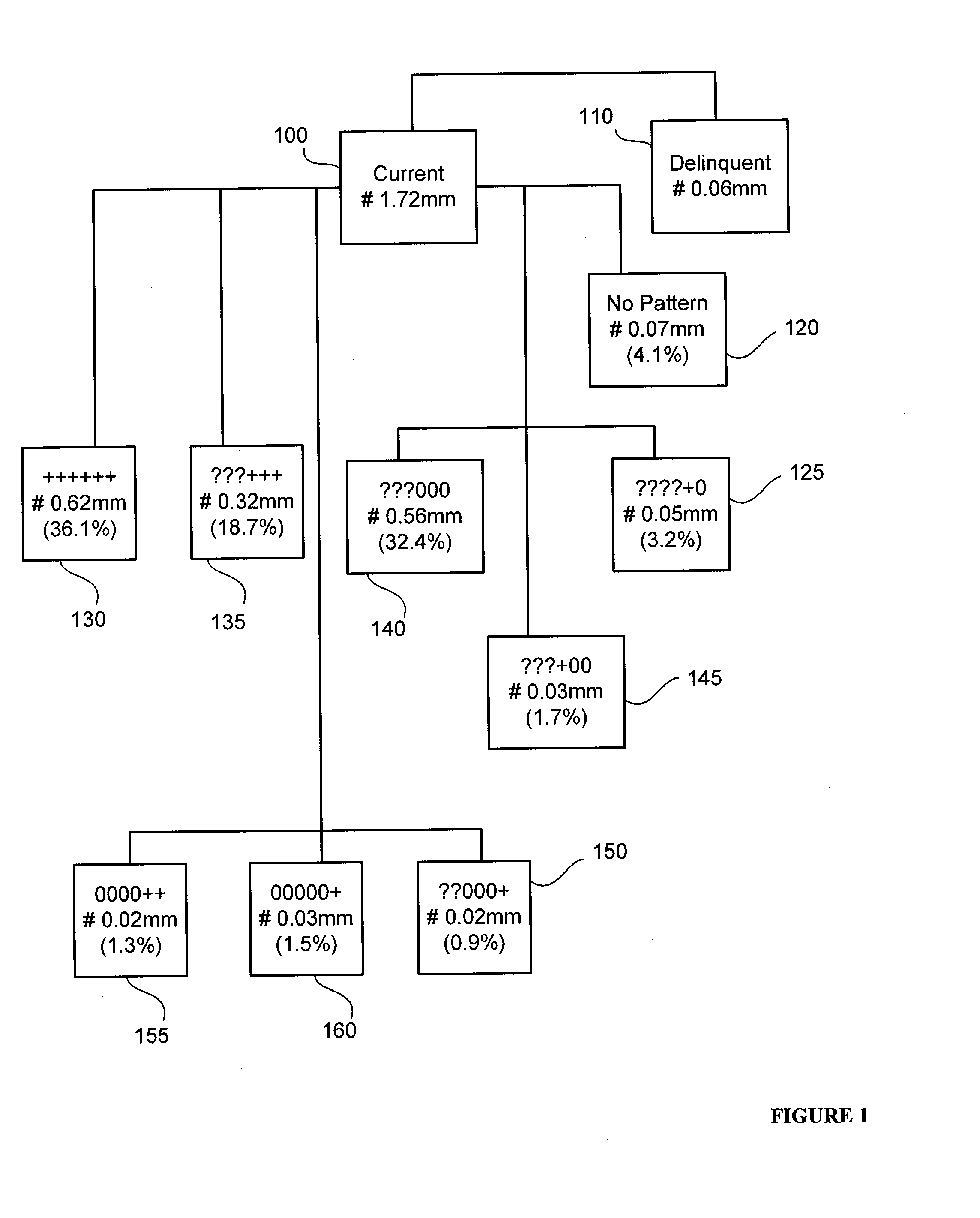

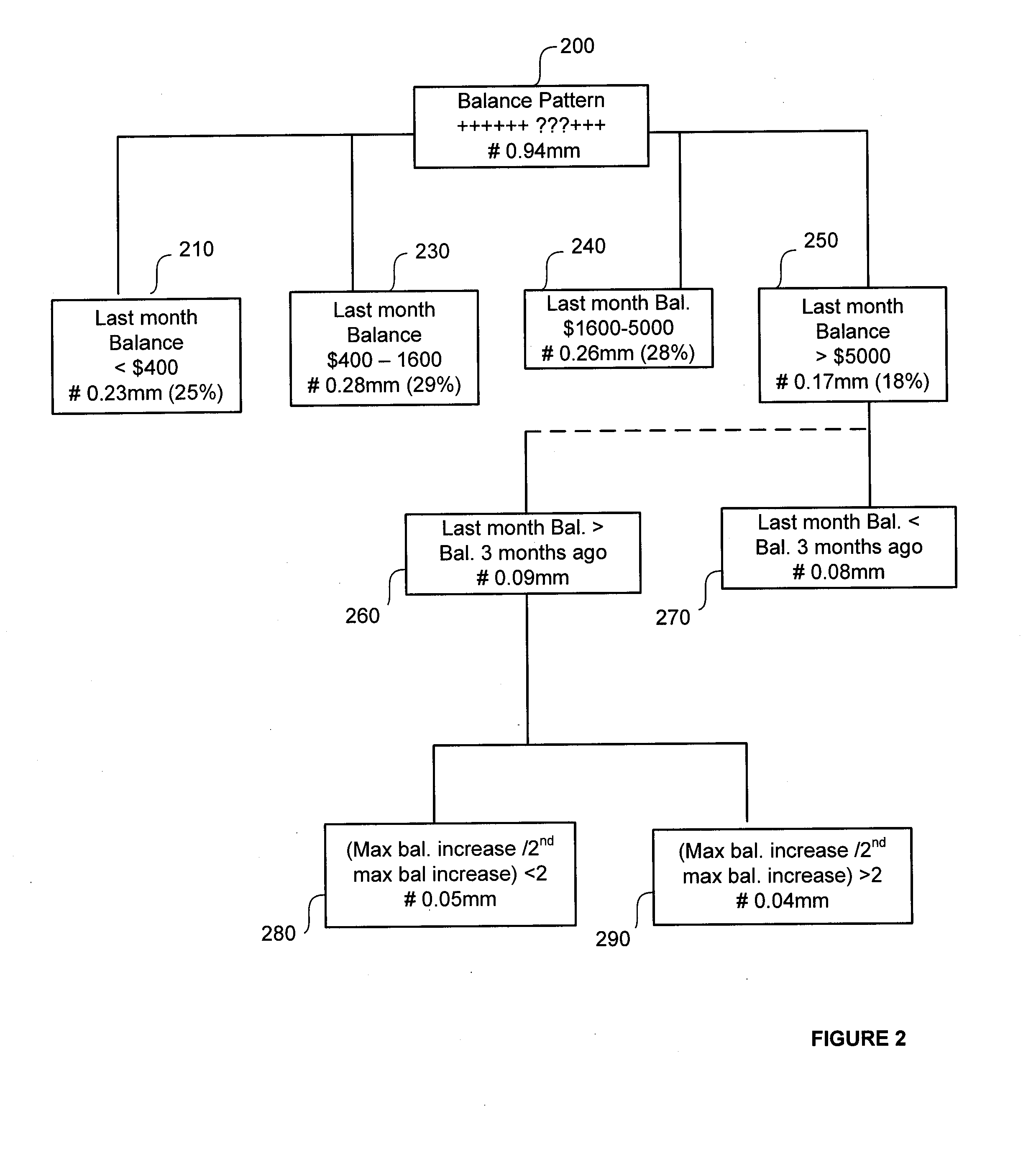

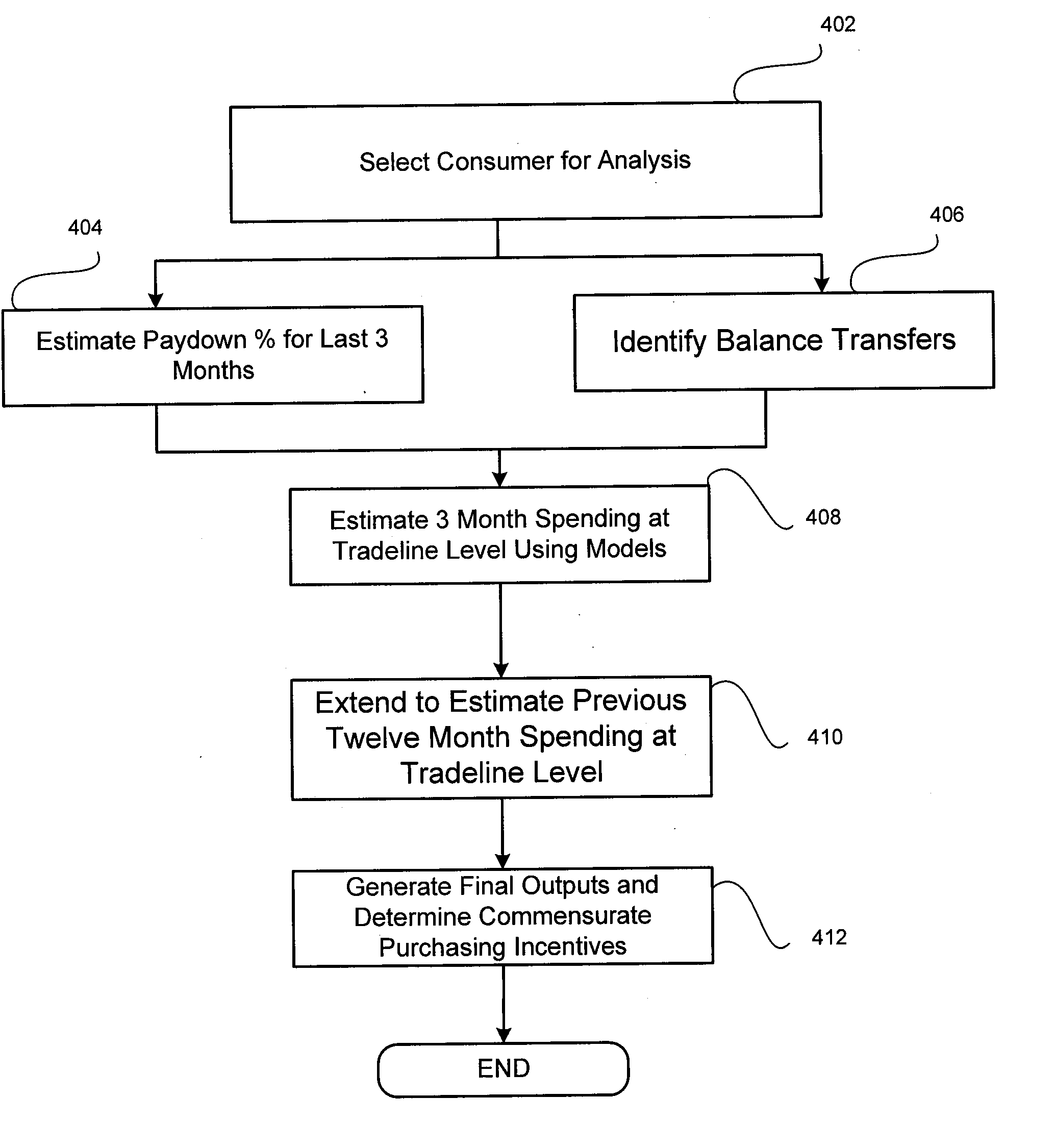

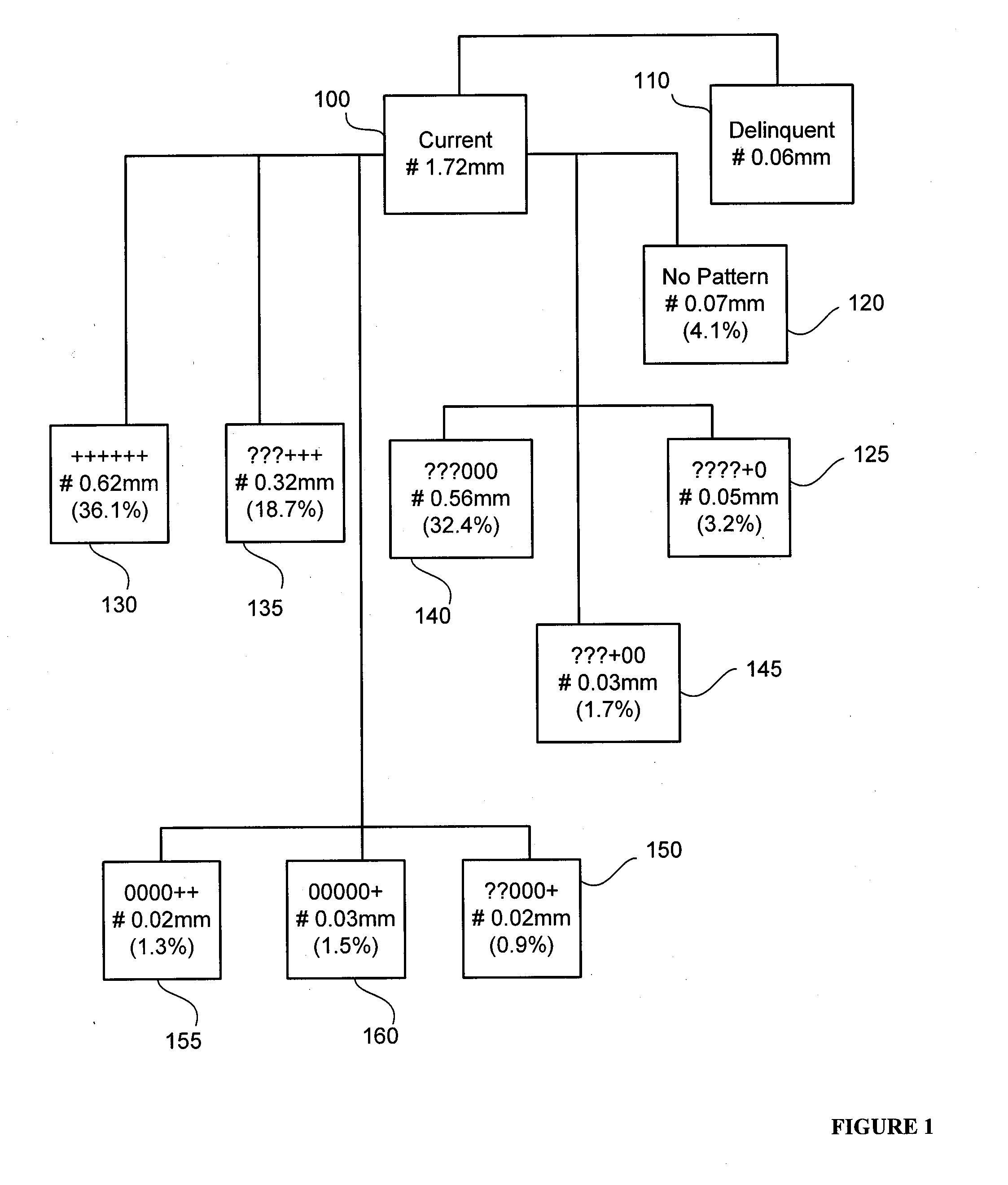

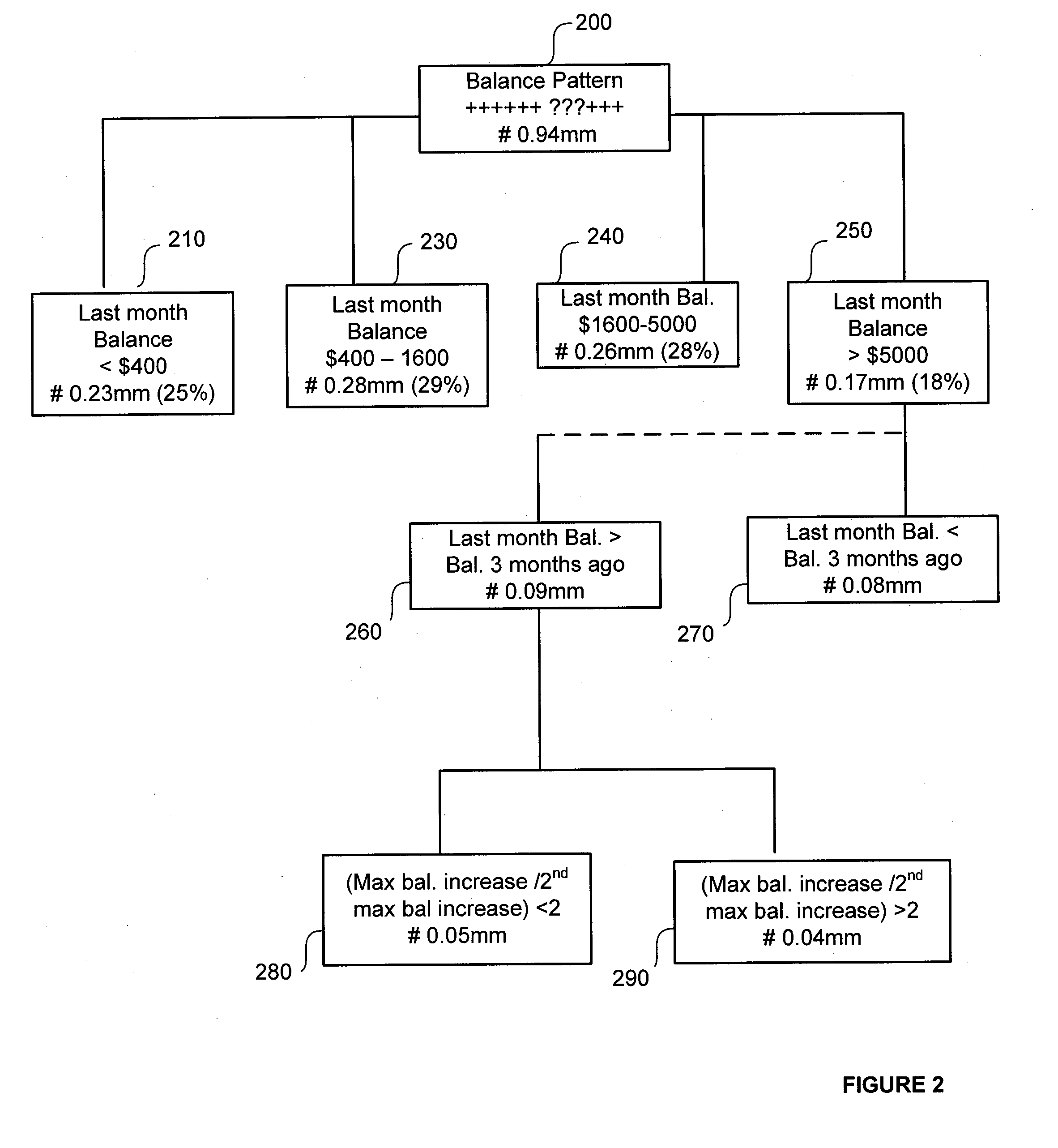

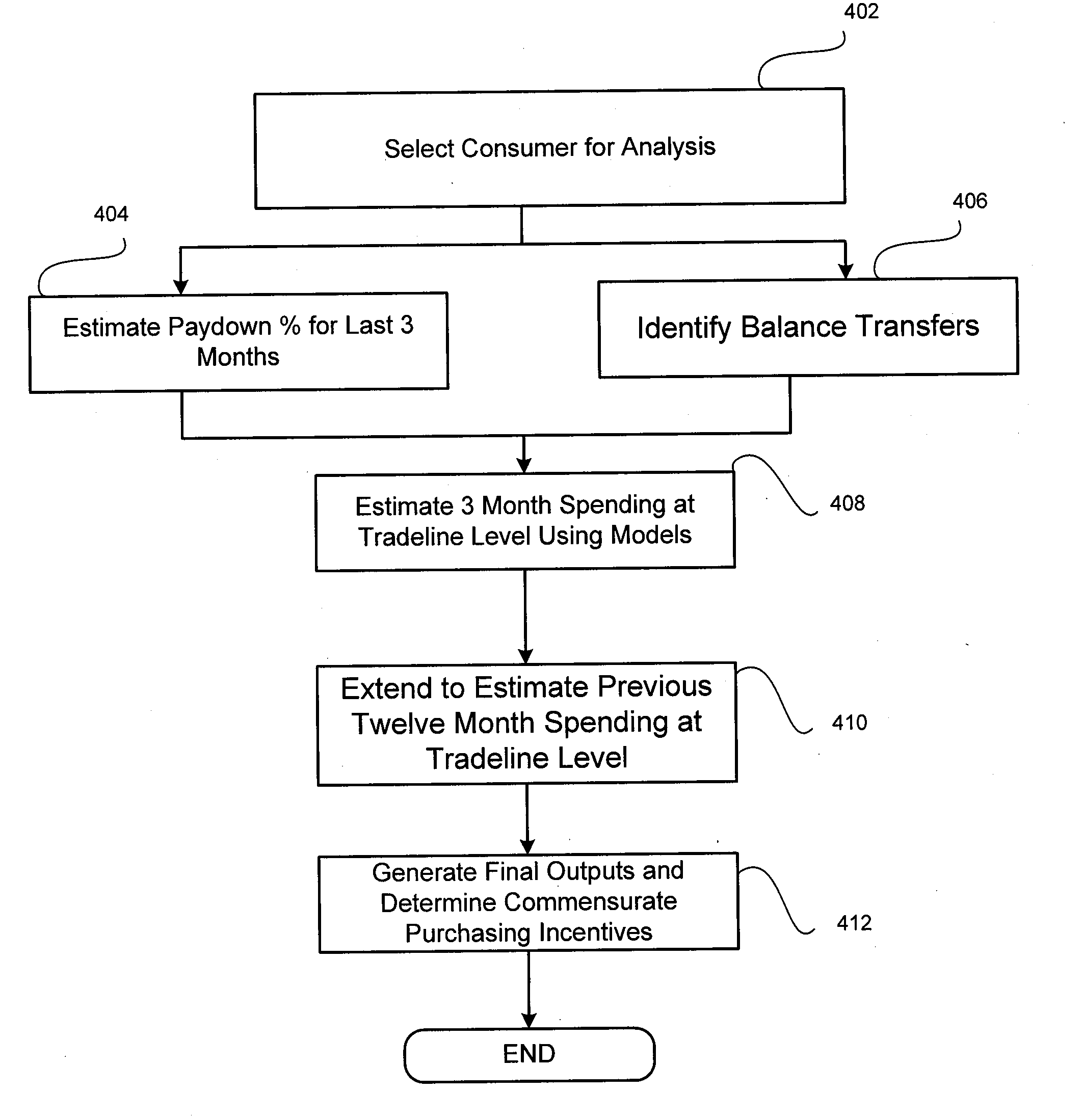

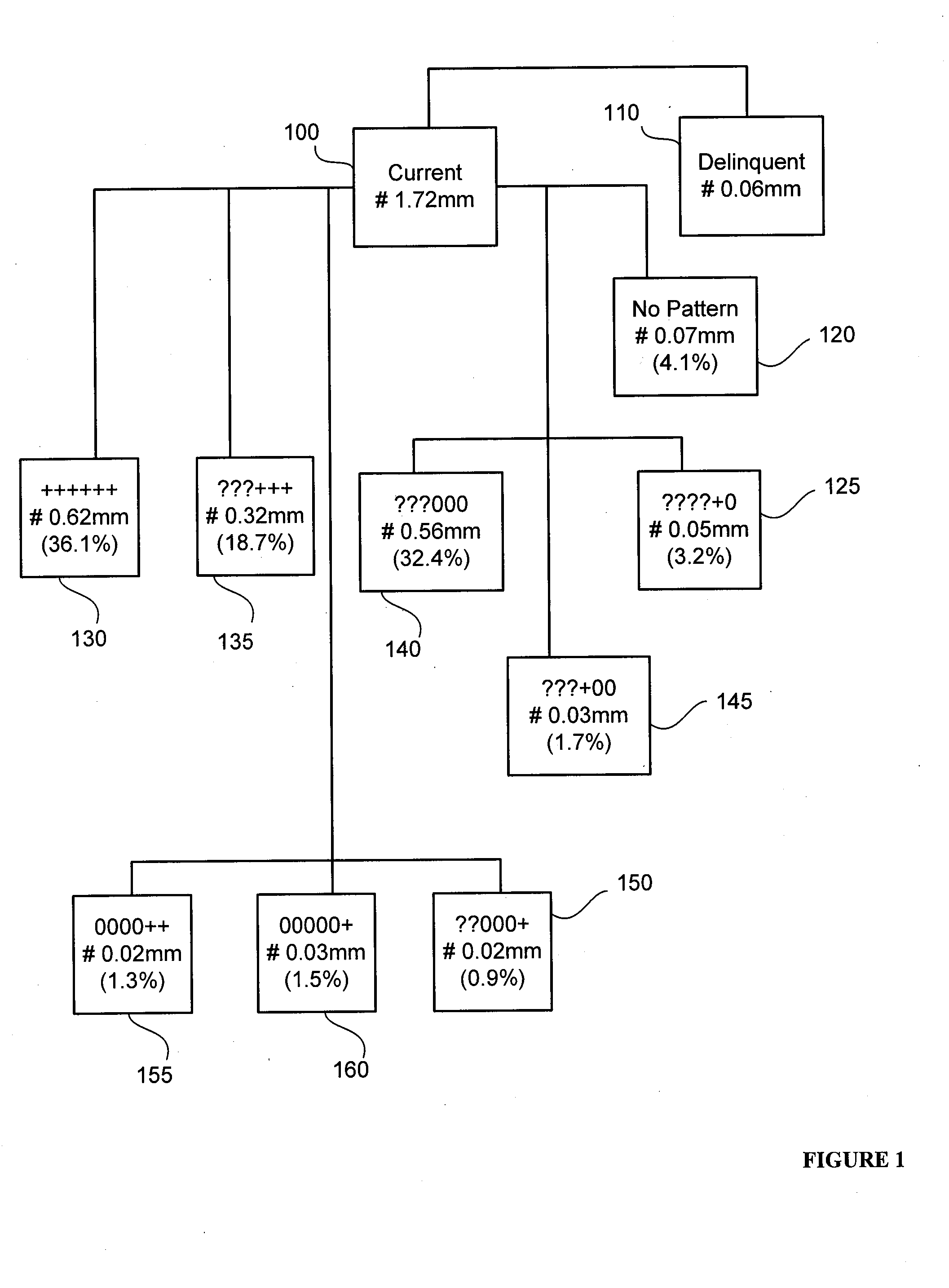

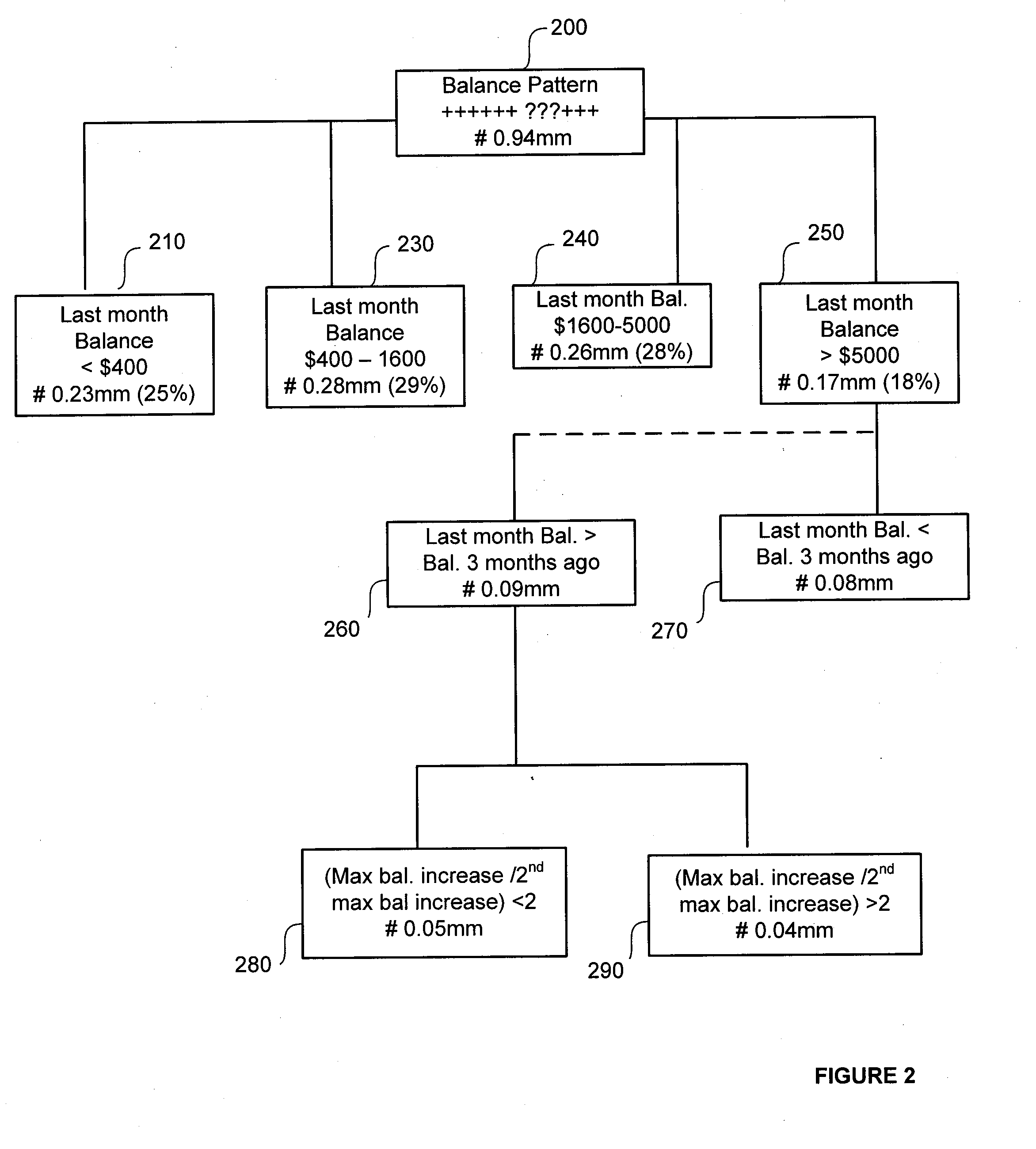

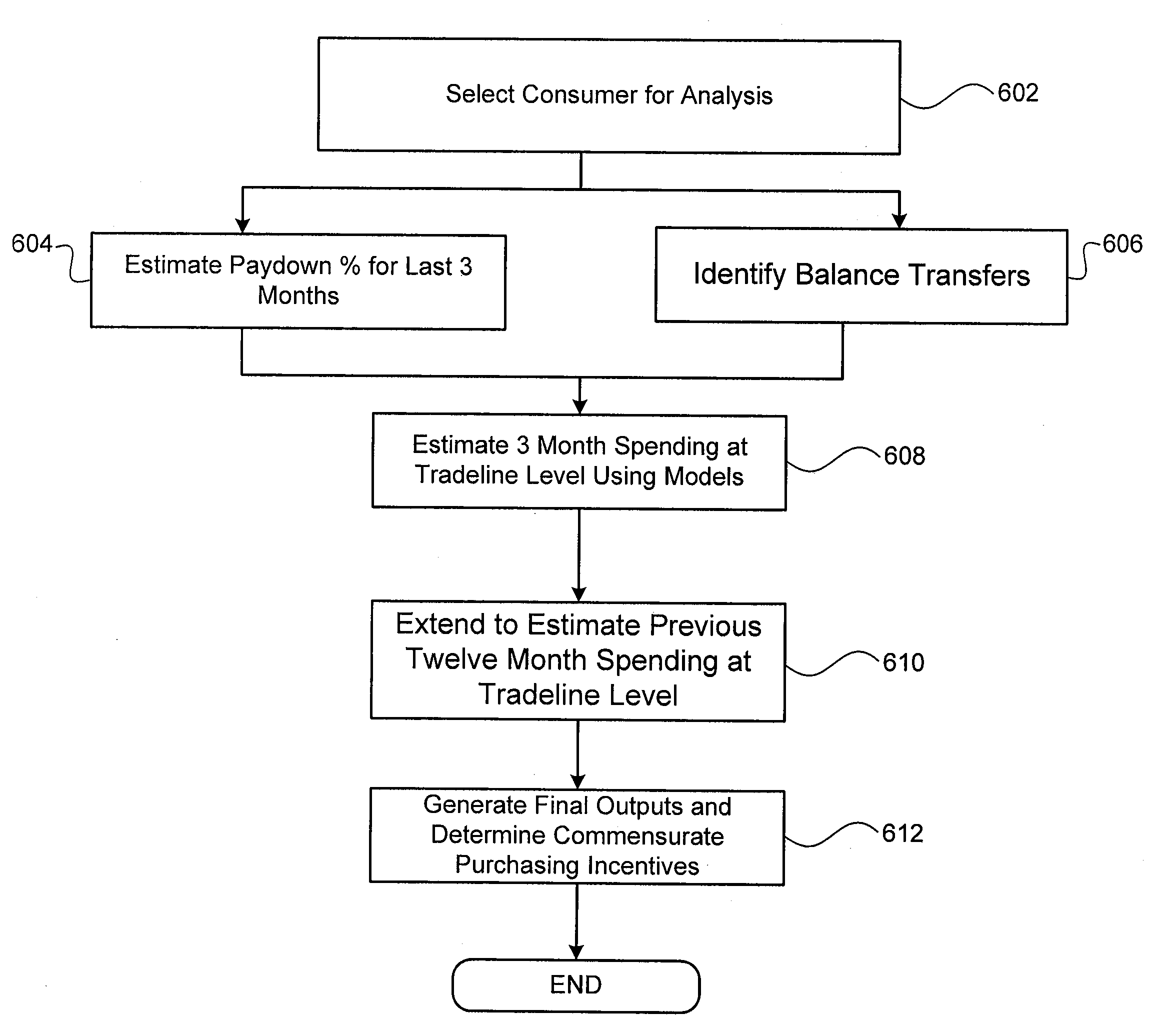

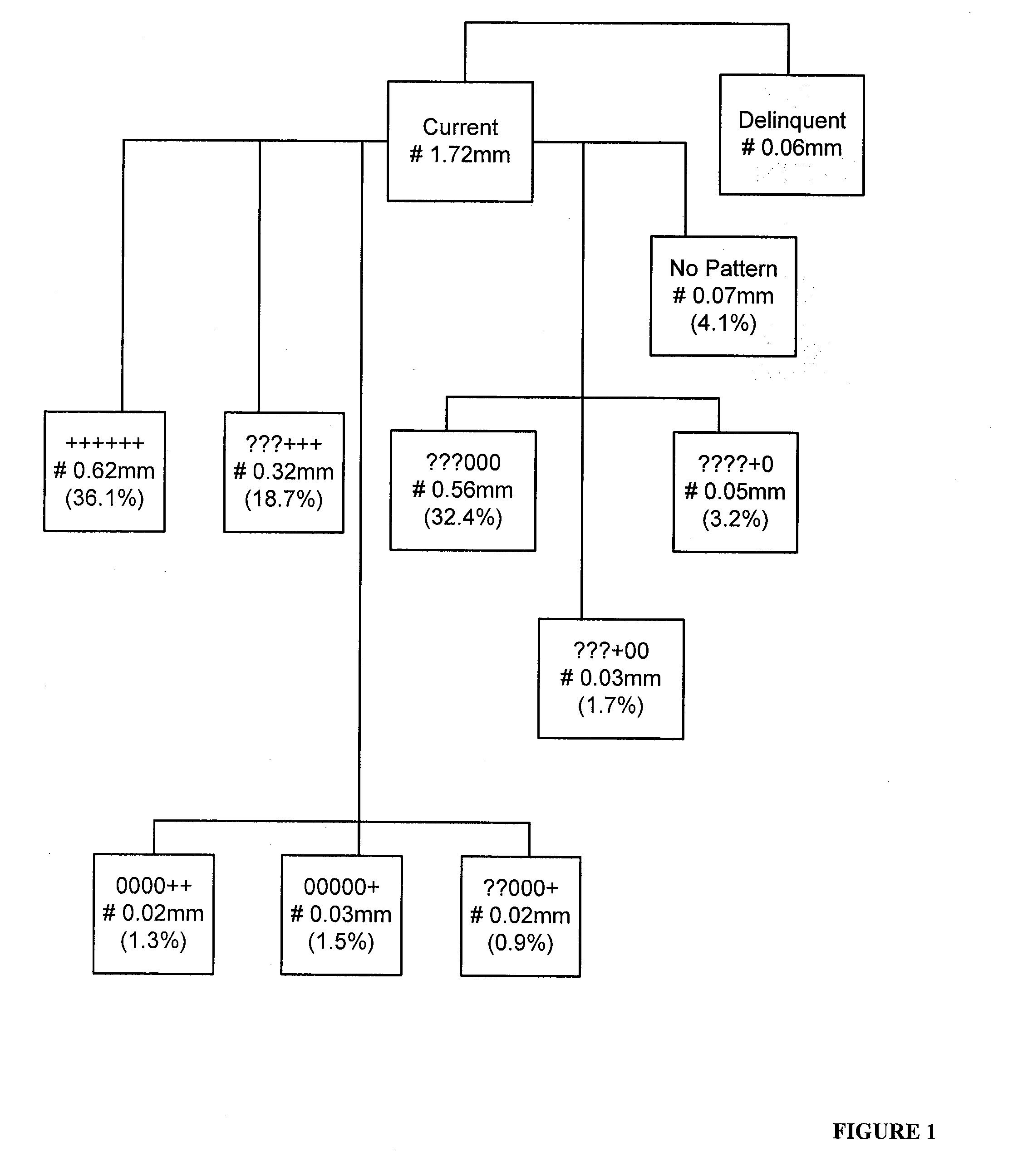

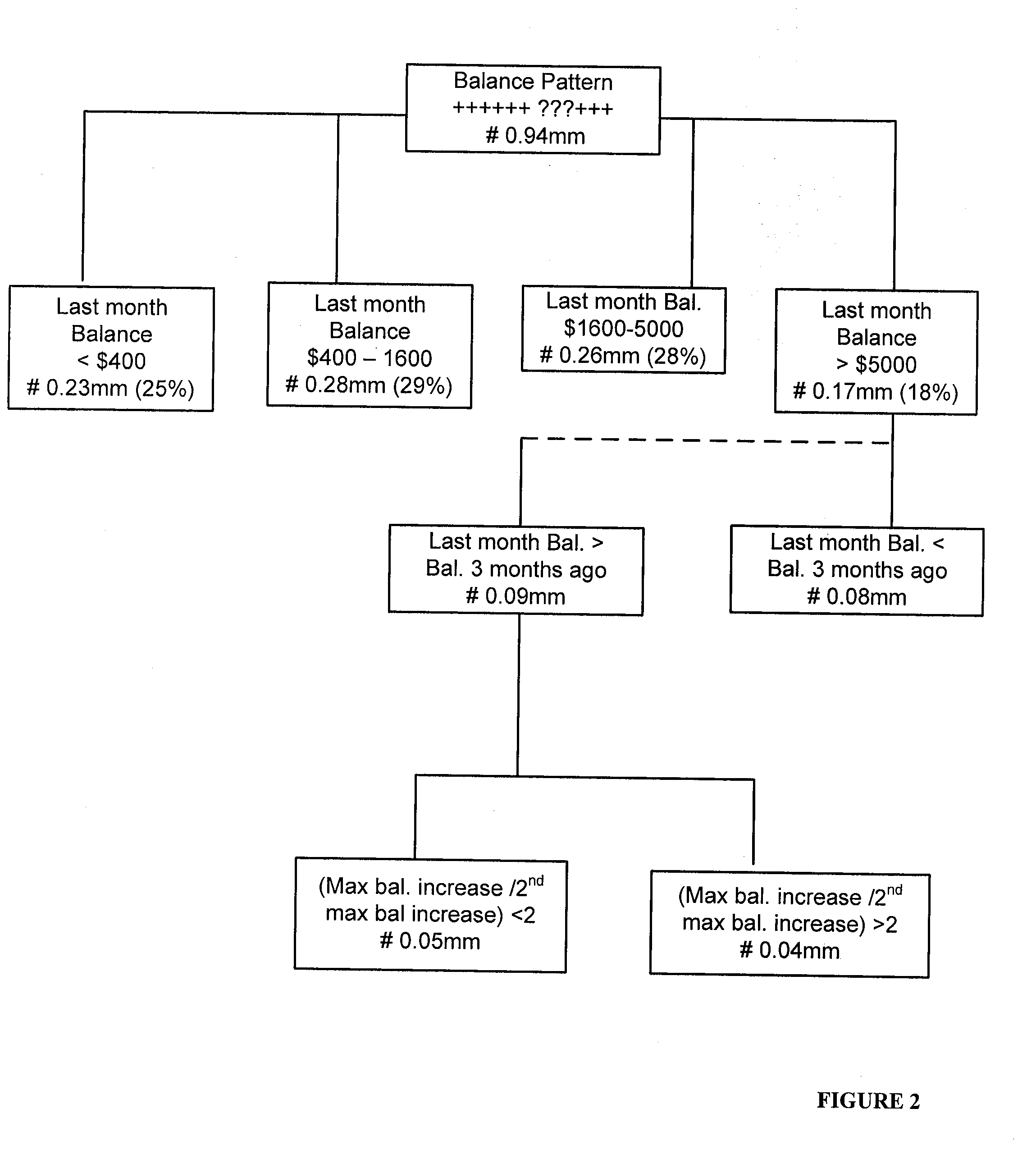

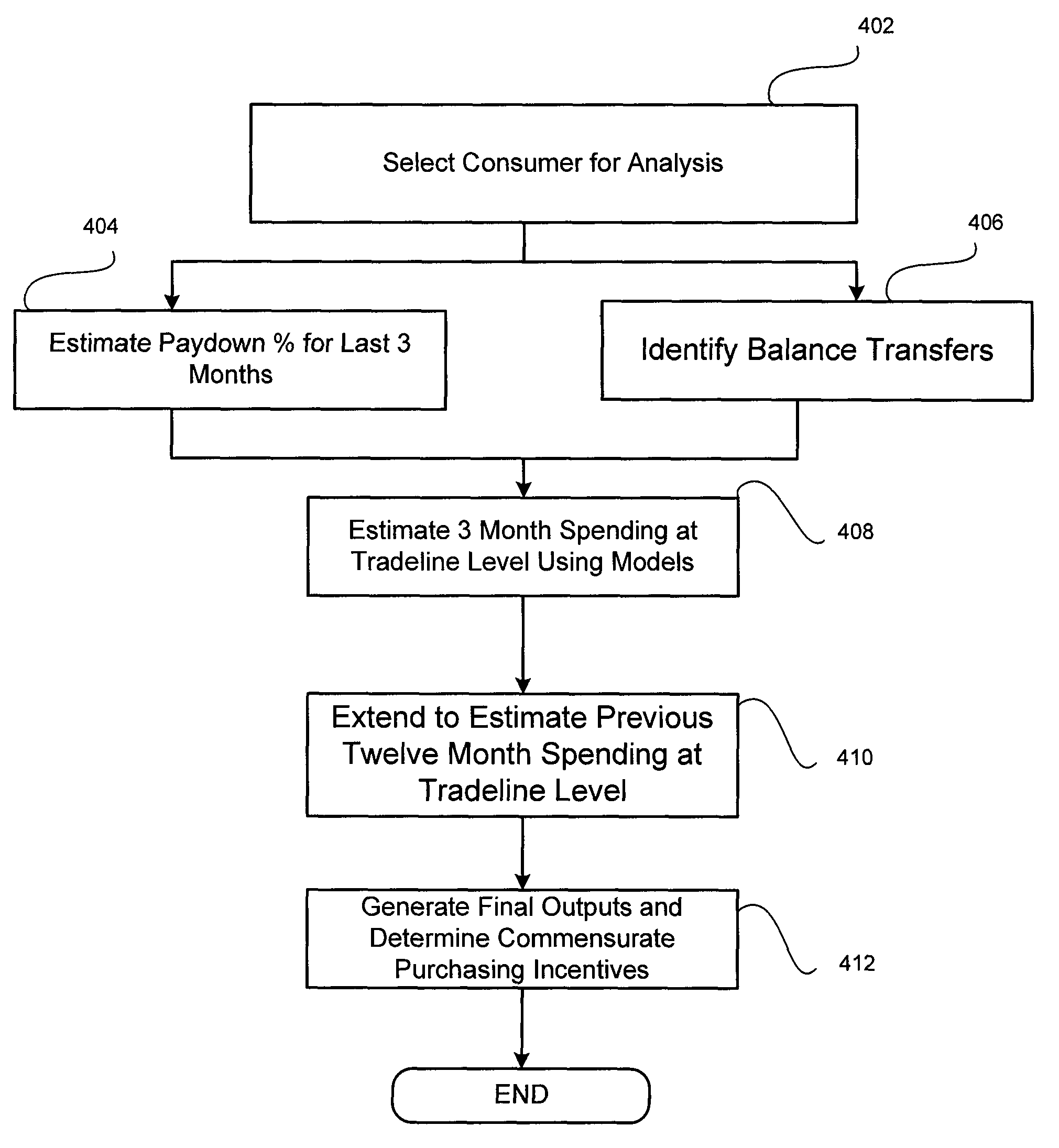

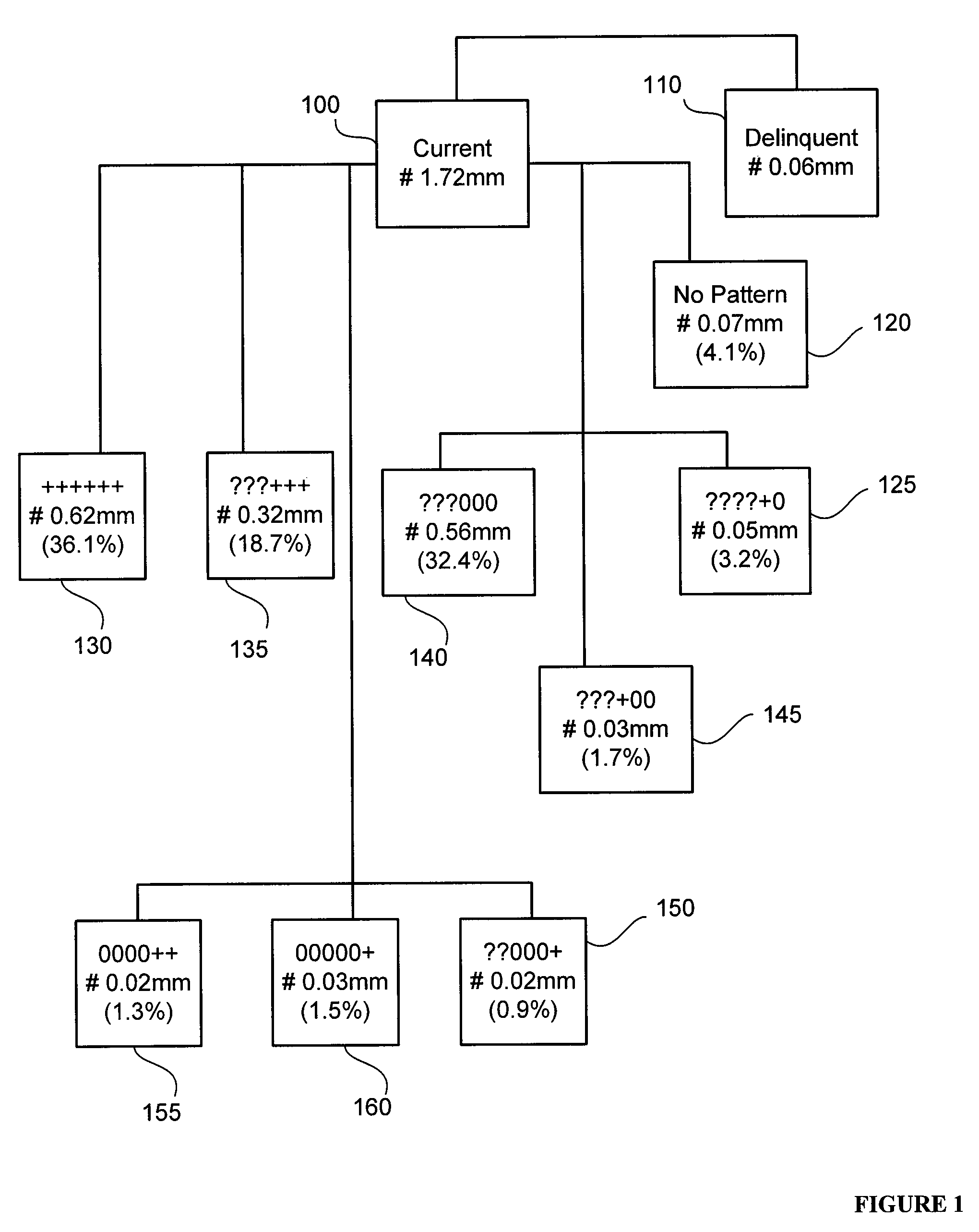

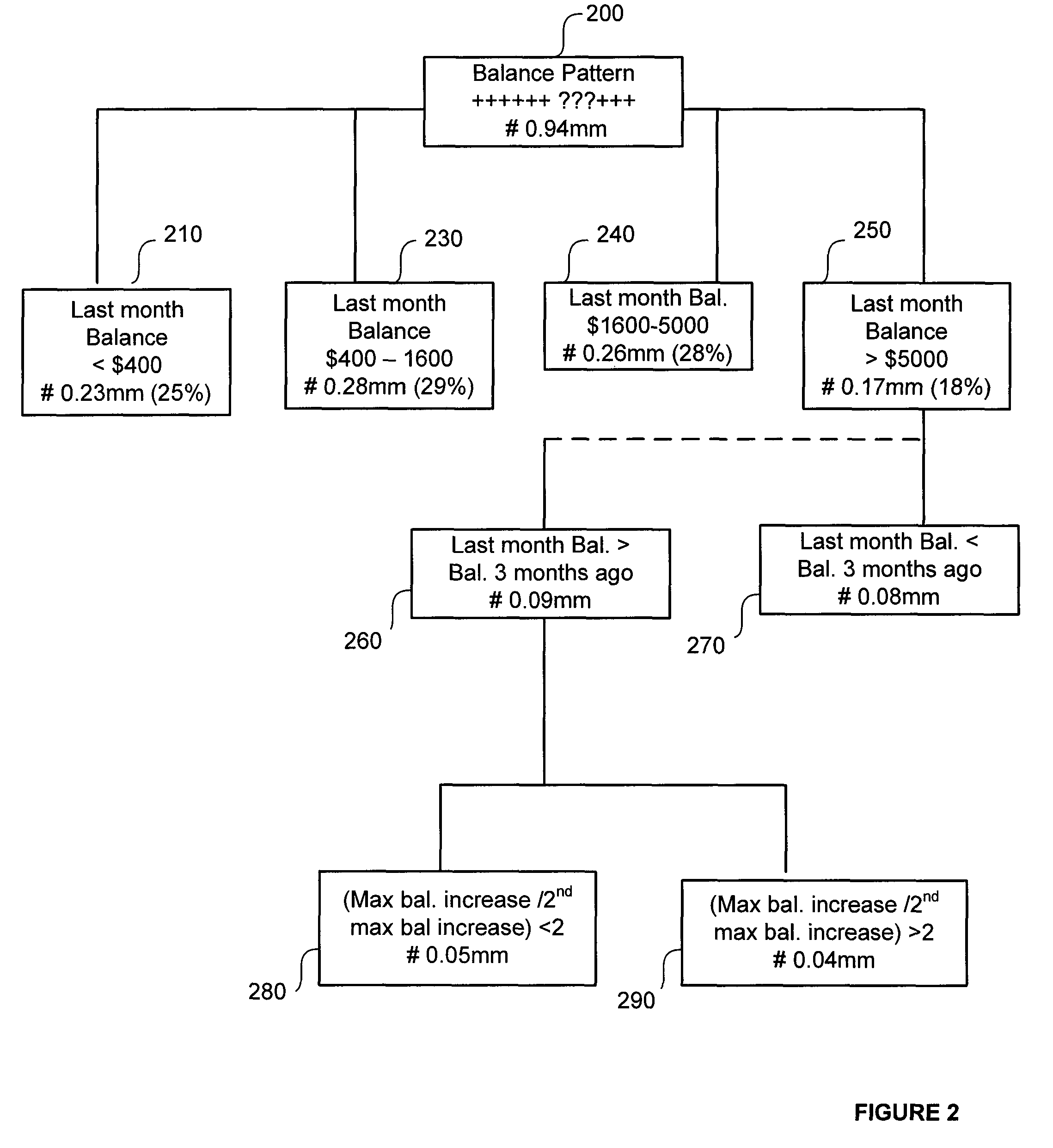

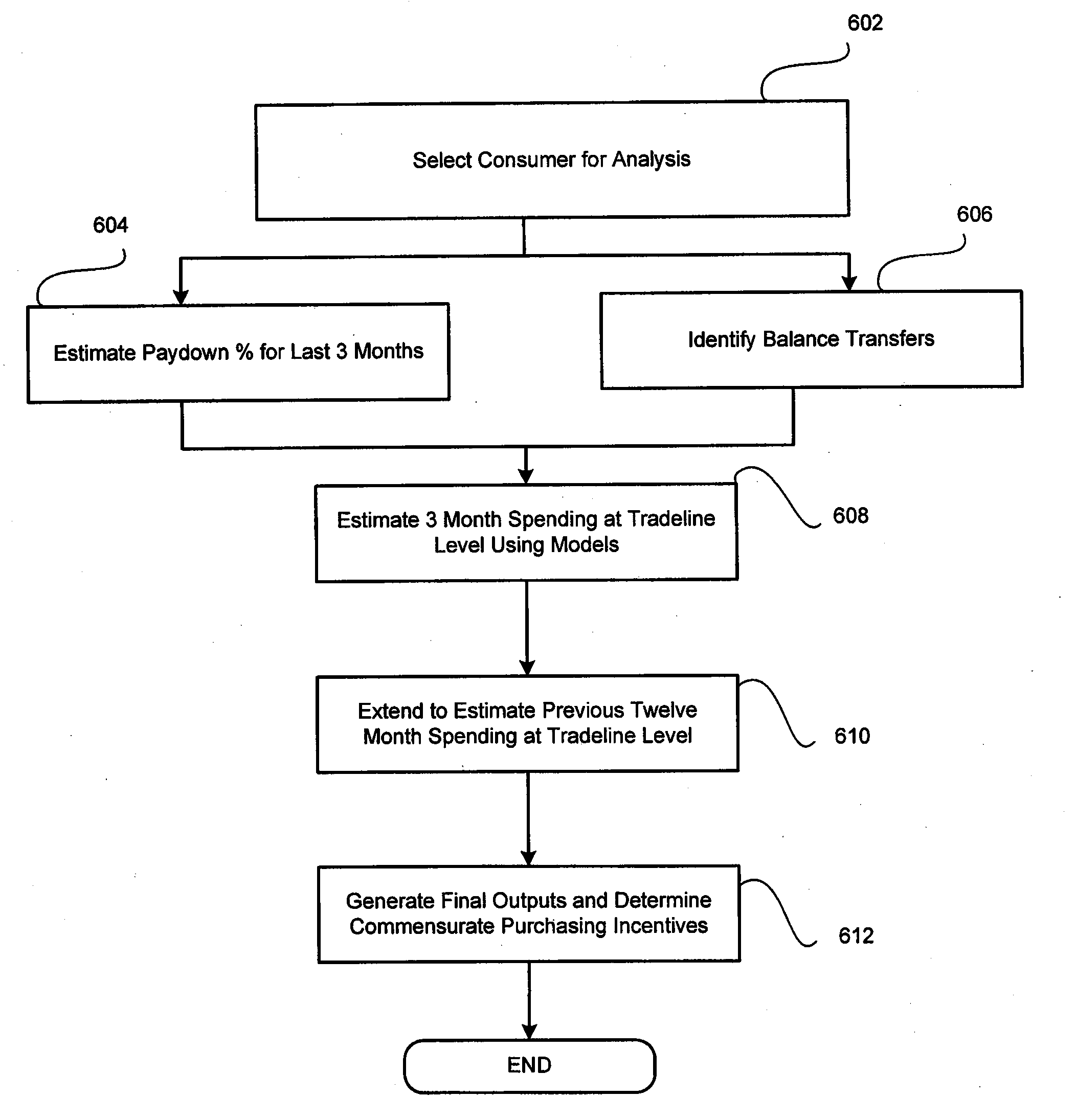

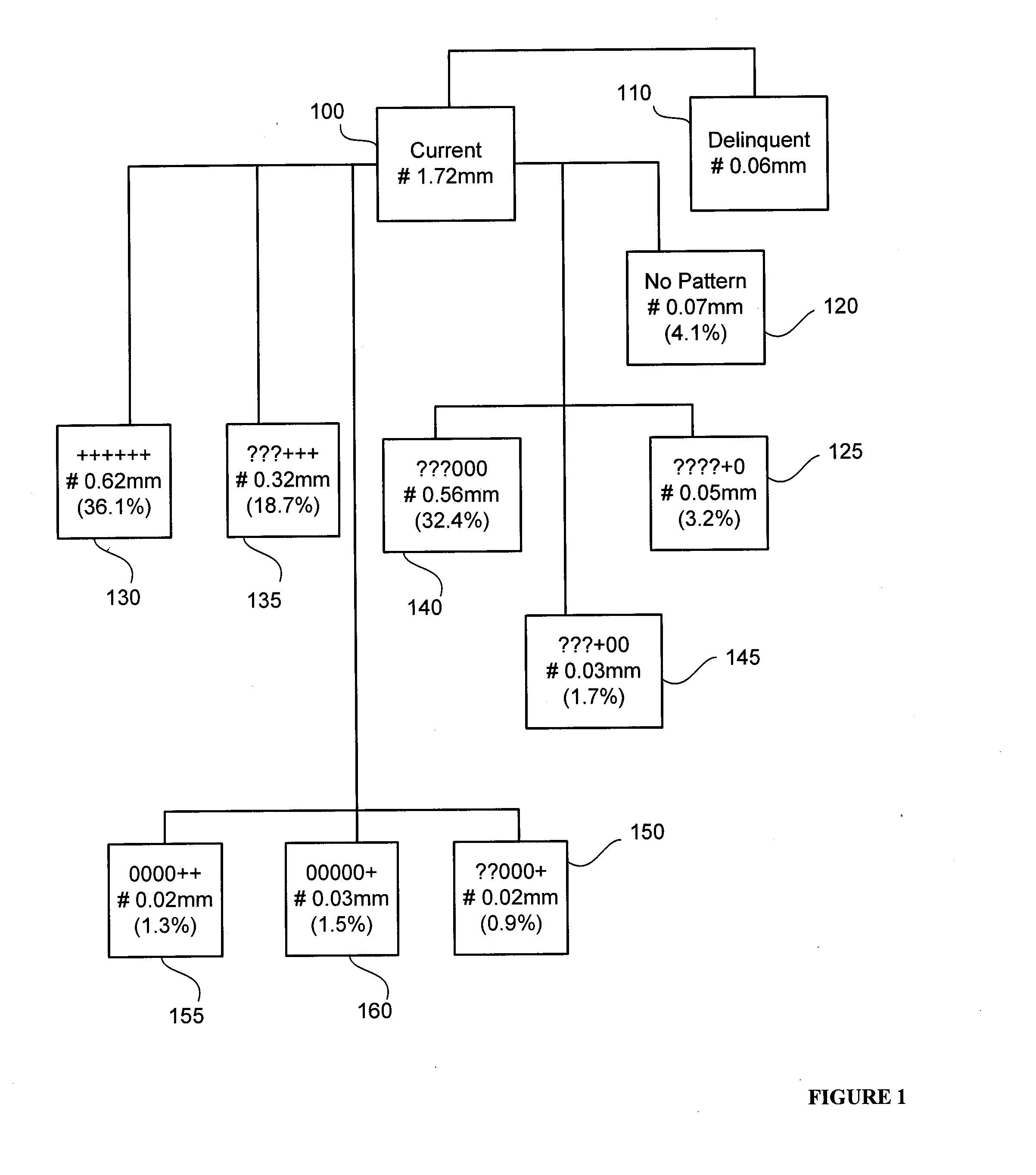

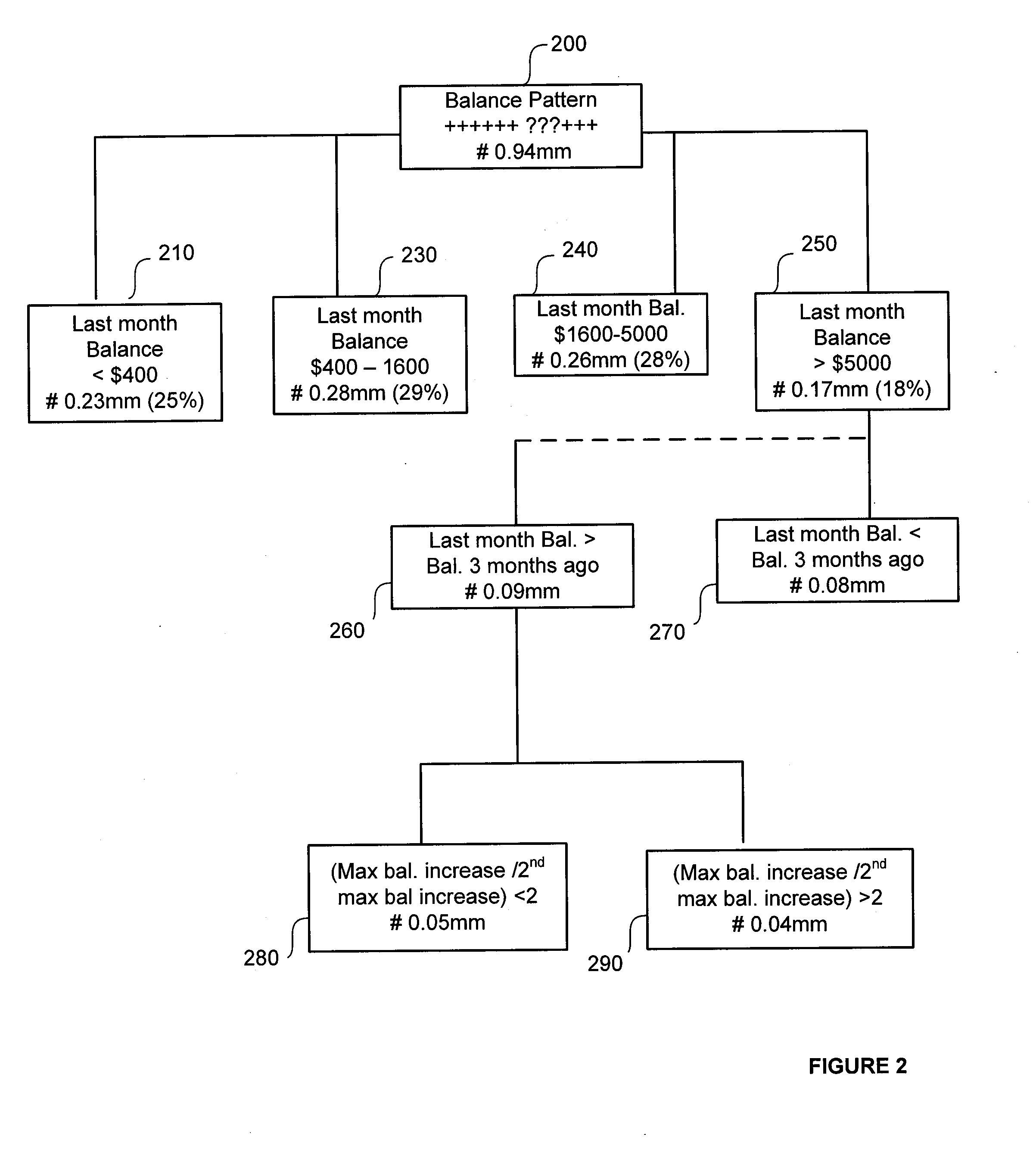

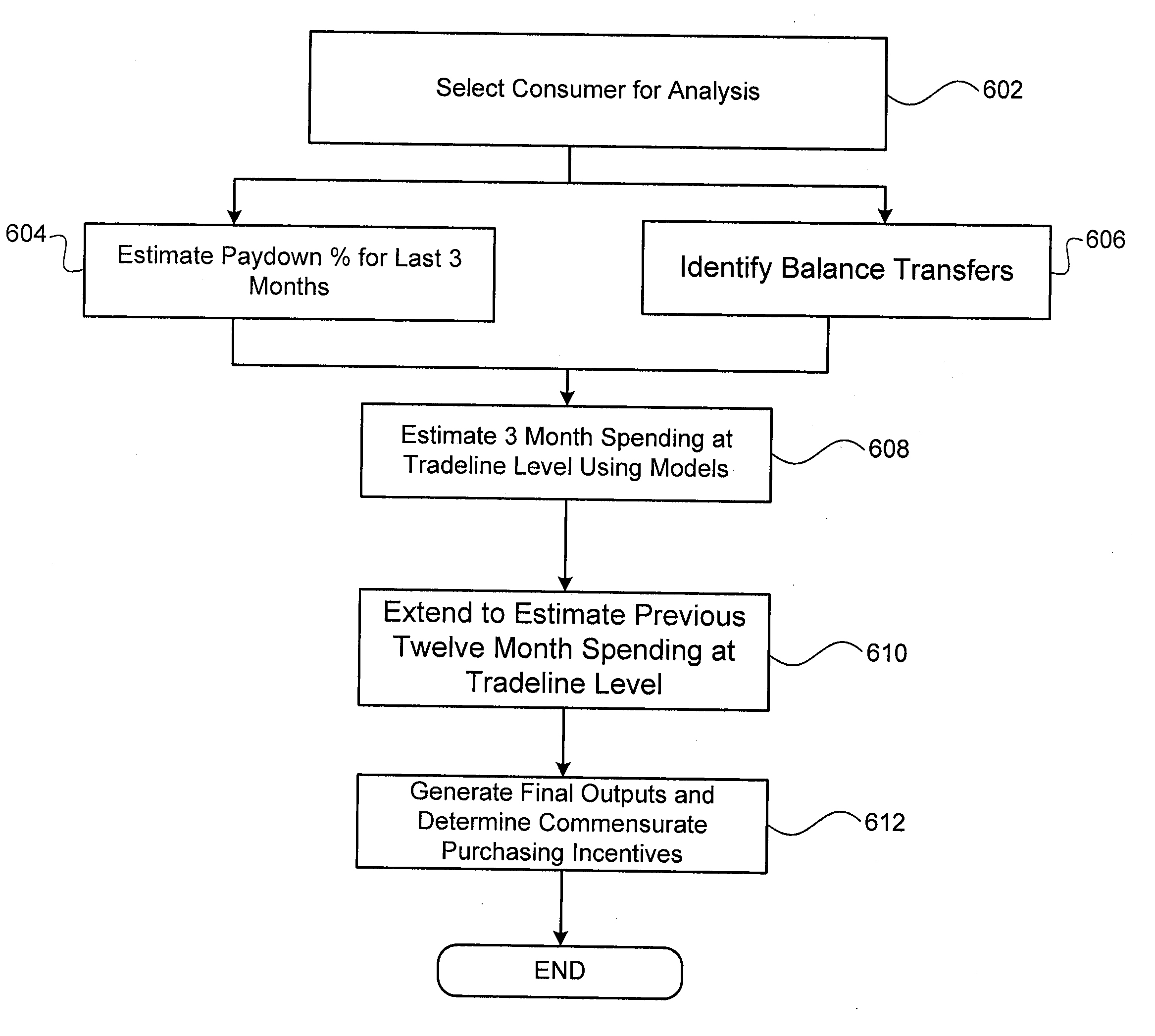

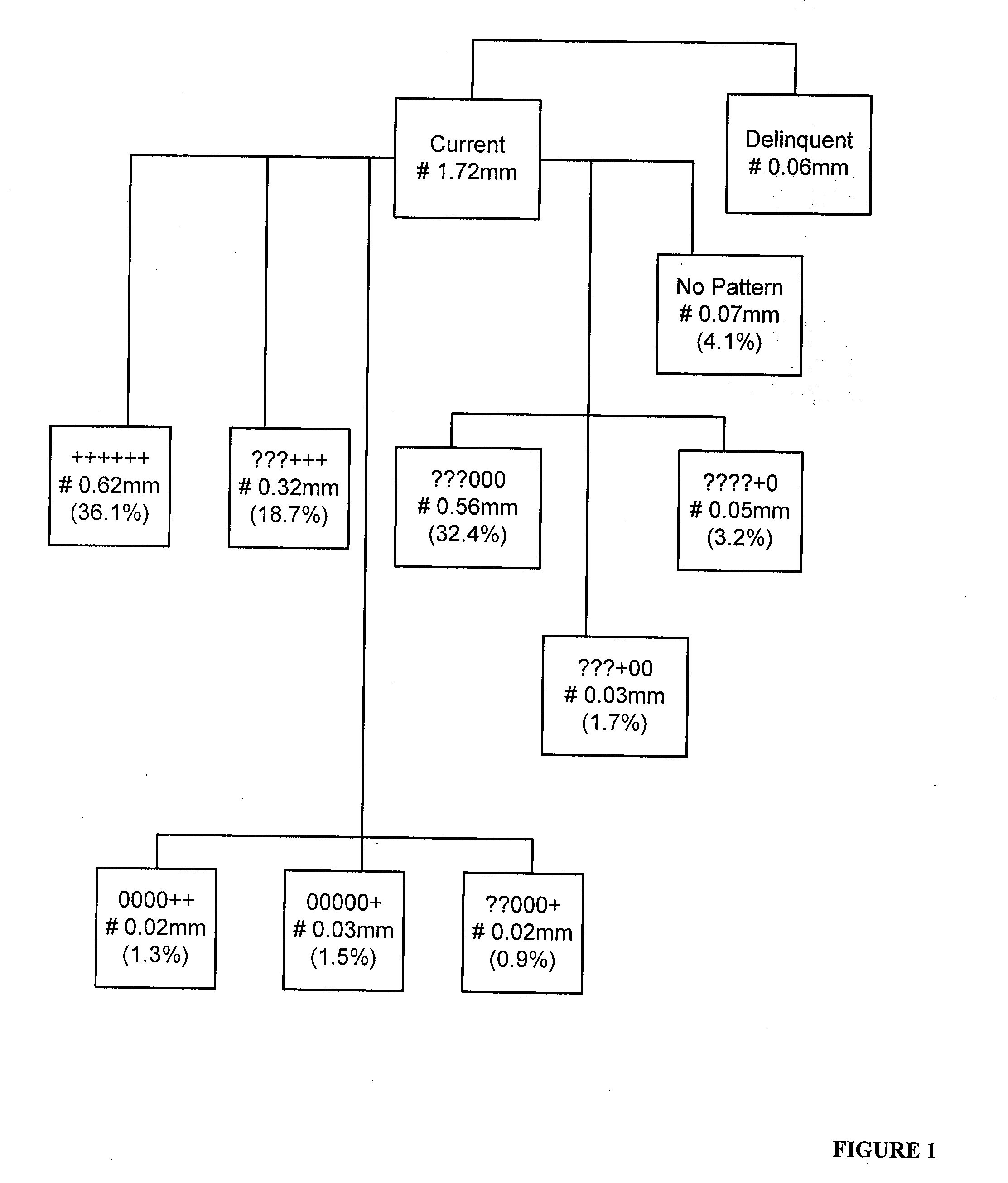

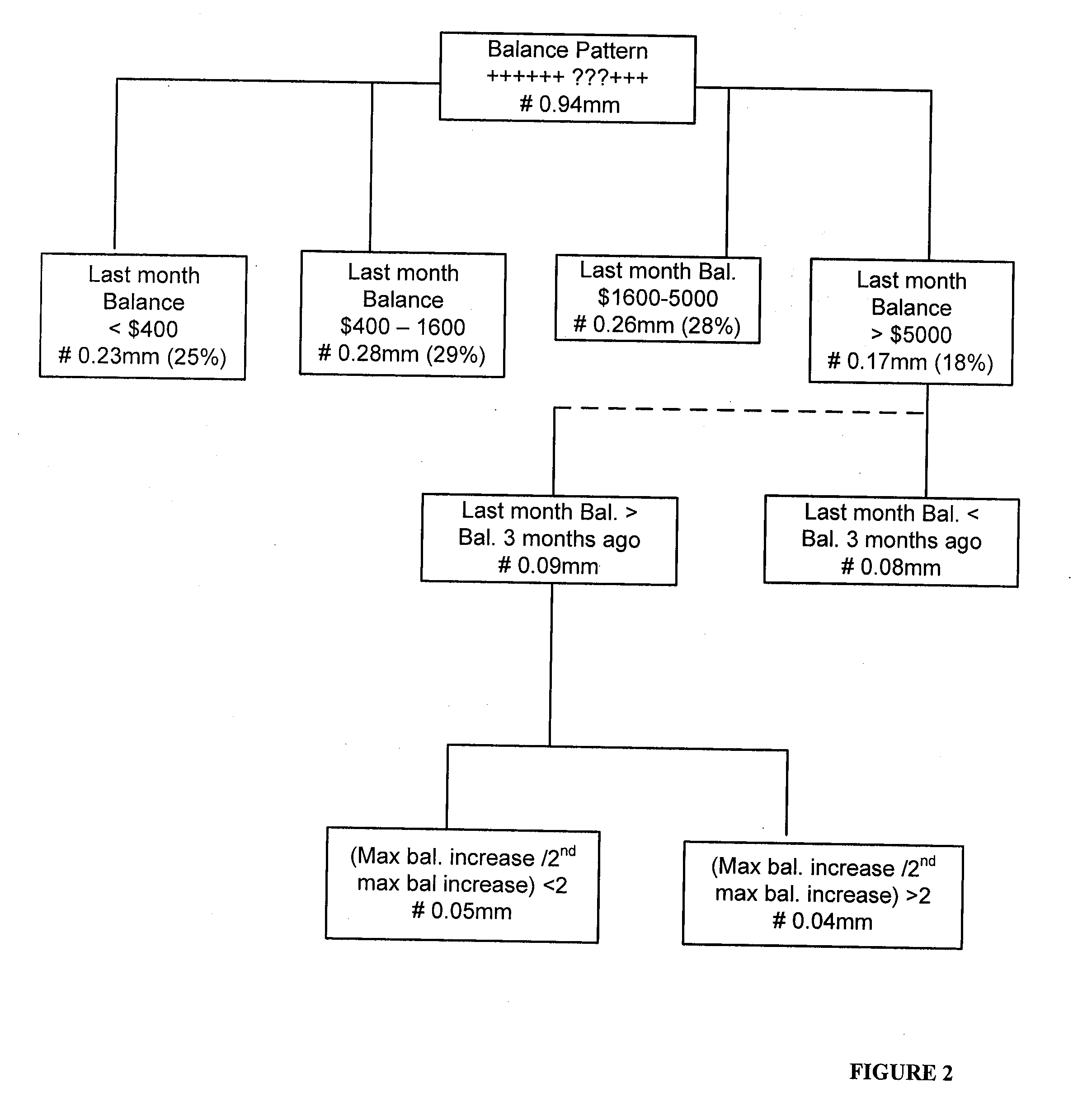

ActiveUS20090222379A1Improve business satisfactionFinancePayment architectureFinancial data processingBehavioral analytics

The present invention generally relates to financial data processing, and in particular it relates to credit scoring, consumer profiling, consumer behavior analysis and modeling. More specifically, it relates to risk modeling using the inputs of credit bureau data, size of wallet data, and, optionally, internal data.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

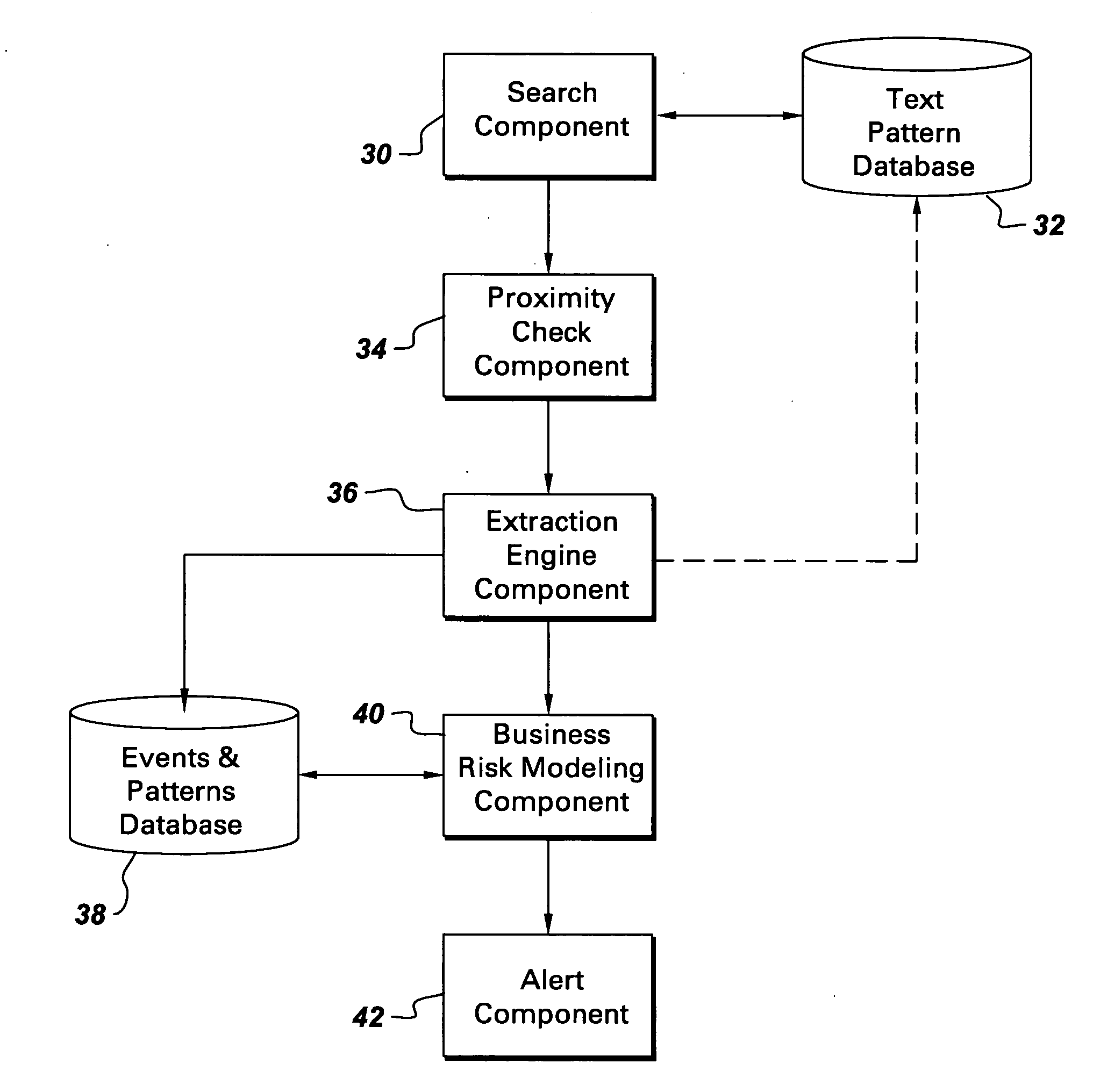

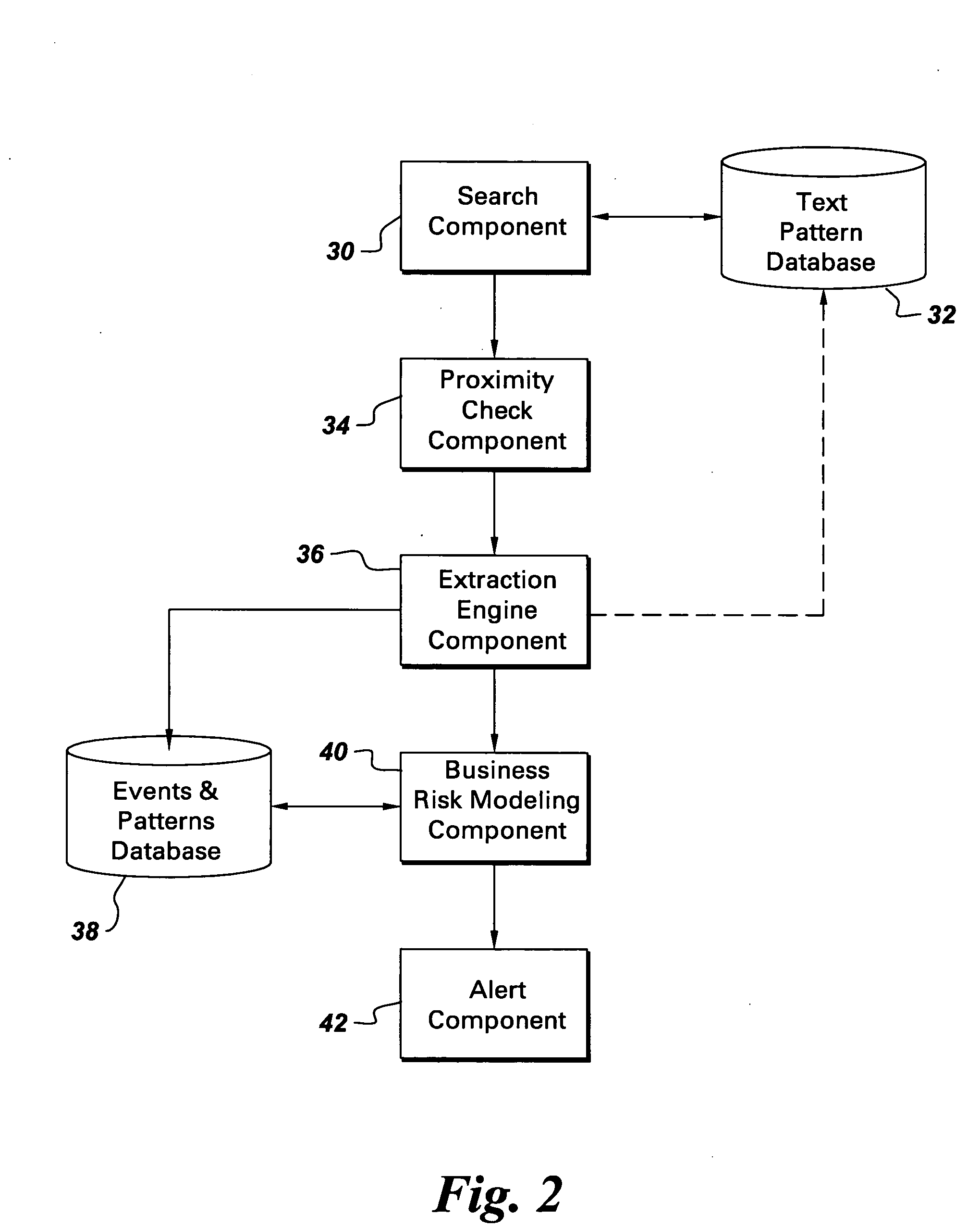

Method, system and computer product for analyzing business risk using event information extracted from natural language sources

Method, system and computer product for analyzing business risk using event information extracted from natural language sources. In this invention, articles each containing qualitative business event information relevant to a target business entity are retrieved. A structured events record of details for the qualitative business event information is extracted from the articles. The structured events record is applied to a business risk model that uses temporal reasoning to map qualitative business event information to business risk. The business risk model determines the business risk of the target business entity based on temporal proximity and order of the qualitative business event information in the structured events record.

Owner:GENERAL ELECTRIC CO

Total structural risk model

InactiveUS20090222380A1Improve business satisfactionFinanceFinancial data processingBehavioral analytics

The present invention generally relates to financial data processing, and in particular it relates to credit scoring, consumer profiling, consumer behavior analysis and modeling. More specifically, it relates to risk modeling using the inputs of credit bureau data, size of wallet data, and, optionally, internal data.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

Total structural risk model

ActiveUS20090222377A1Improve business satisfactionFinanceDigital data processing detailsFinancial data processingBehavioral analytics

The present invention generally relates to financial data processing, and in particular it relates to credit scoring, consumer profiling, consumer behavior analysis and modeling. More specifically, it relates to risk modeling using the inputs of credit bureau data, size of wallet data, and, optionally, internal data.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

Total structural risk model

ActiveUS20090222374A1Improve business satisfactionFinanceFinancial data processingBehavioral analytics

The present invention generally relates to financial data processing, and in particular it relates to credit scoring, consumer profiling, consumer behavior analysis and modeling. More specifically, it relates to risk modeling using the inputs of credit bureau data, size of wallet data, and, optionally, internal data.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

Total structural risk model

The present invention generally relates to financial data processing, and in particular it relates to credit scoring, consumer profiling, consumer behavior analysis and modeling. More specifically, it relates to risk modeling using the inputs of credit bureau data, size of wallet data, and, optionally, internal data.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

Total structural risk model

InactiveUS20090222378A1Improve business satisfactionFinanceFinancial data processingBehavioral analytics

The present invention generally relates to financial data processing, and in particular it relates to credit scoring, consumer profiling, consumer behavior analysis and modeling. More specifically, it relates to risk modeling using the inputs of credit bureau data, size of wallet data, and, optionally, internal data.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

Total structural risk model

The present invention generally relates to financial data processing, and in particular it relates to credit scoring, consumer profiling, consumer behavior analysis and modeling. More specifically, it relates to risk modeling using the inputs of credit bureau data, size of wallet data, and, optionally, internal data.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

Total structural risk model

InactiveUS20090222373A1Improve business satisfactionFinanceFinancial data processingBehavioral analytics

The present invention generally relates to financial data processing, and in particular it relates to credit scoring, consumer profiling, consumer behavior analysis and modeling. More specifically, it relates to risk modeling using the inputs of credit bureau data, size of wallet data, and, optionally, internal data.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

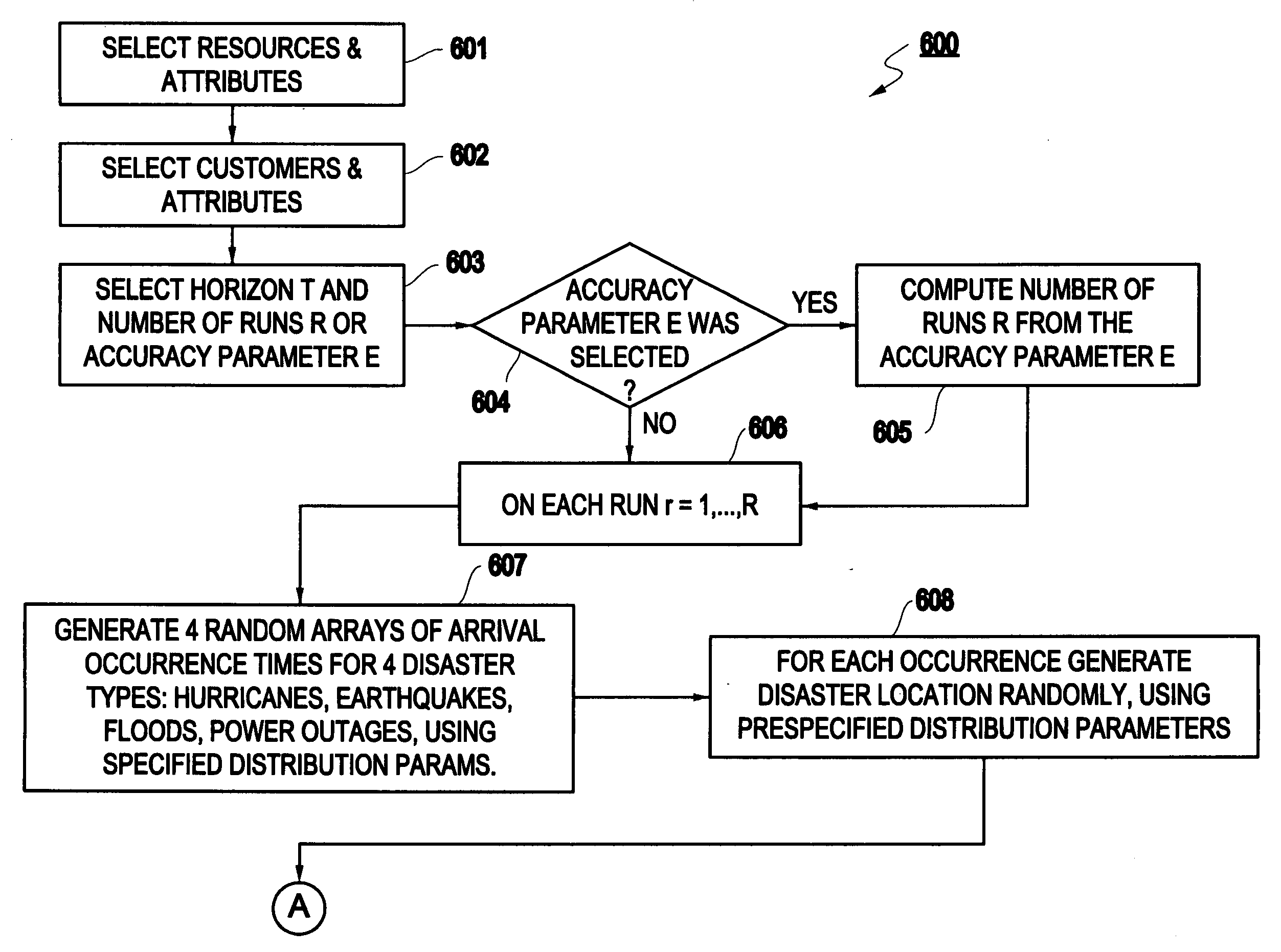

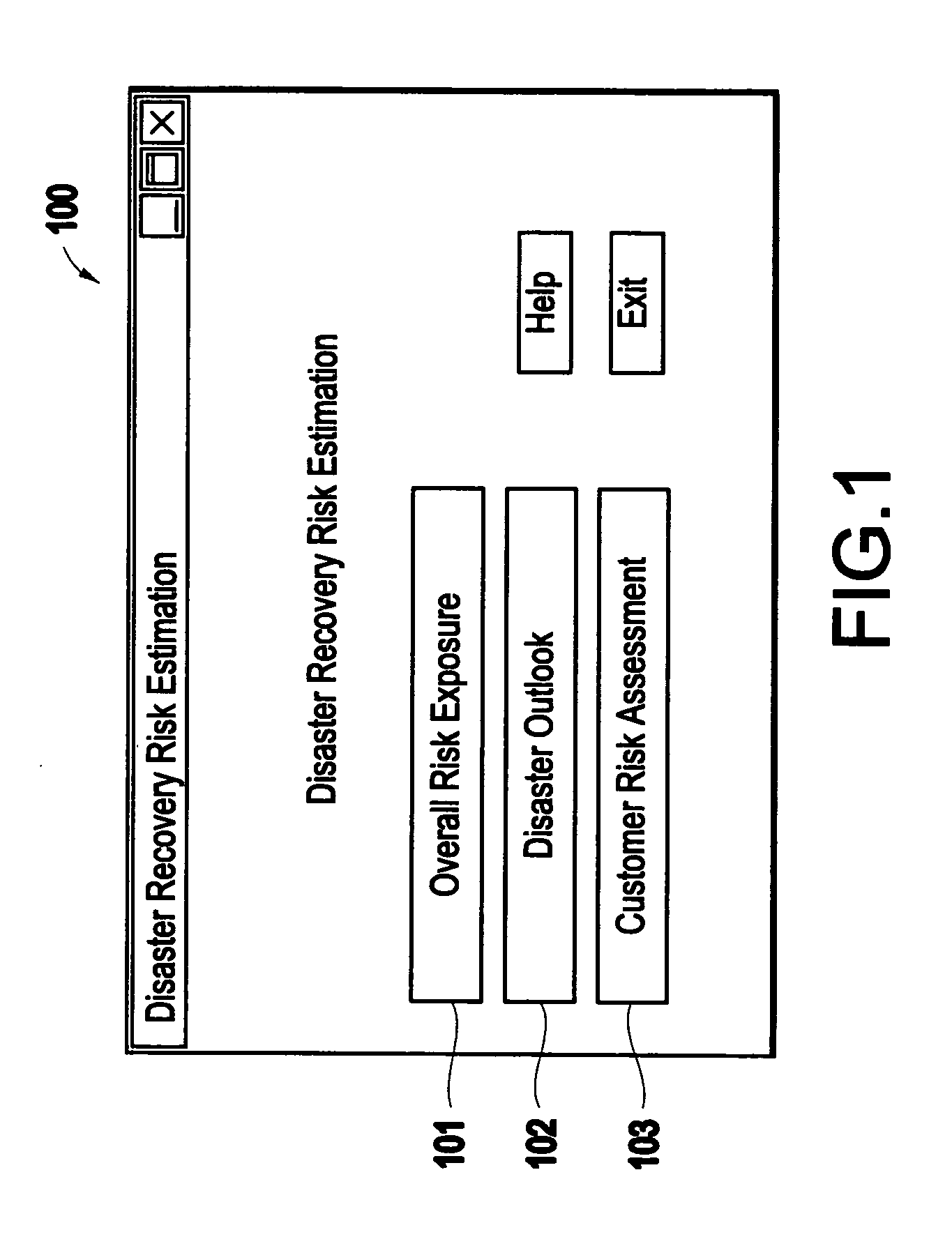

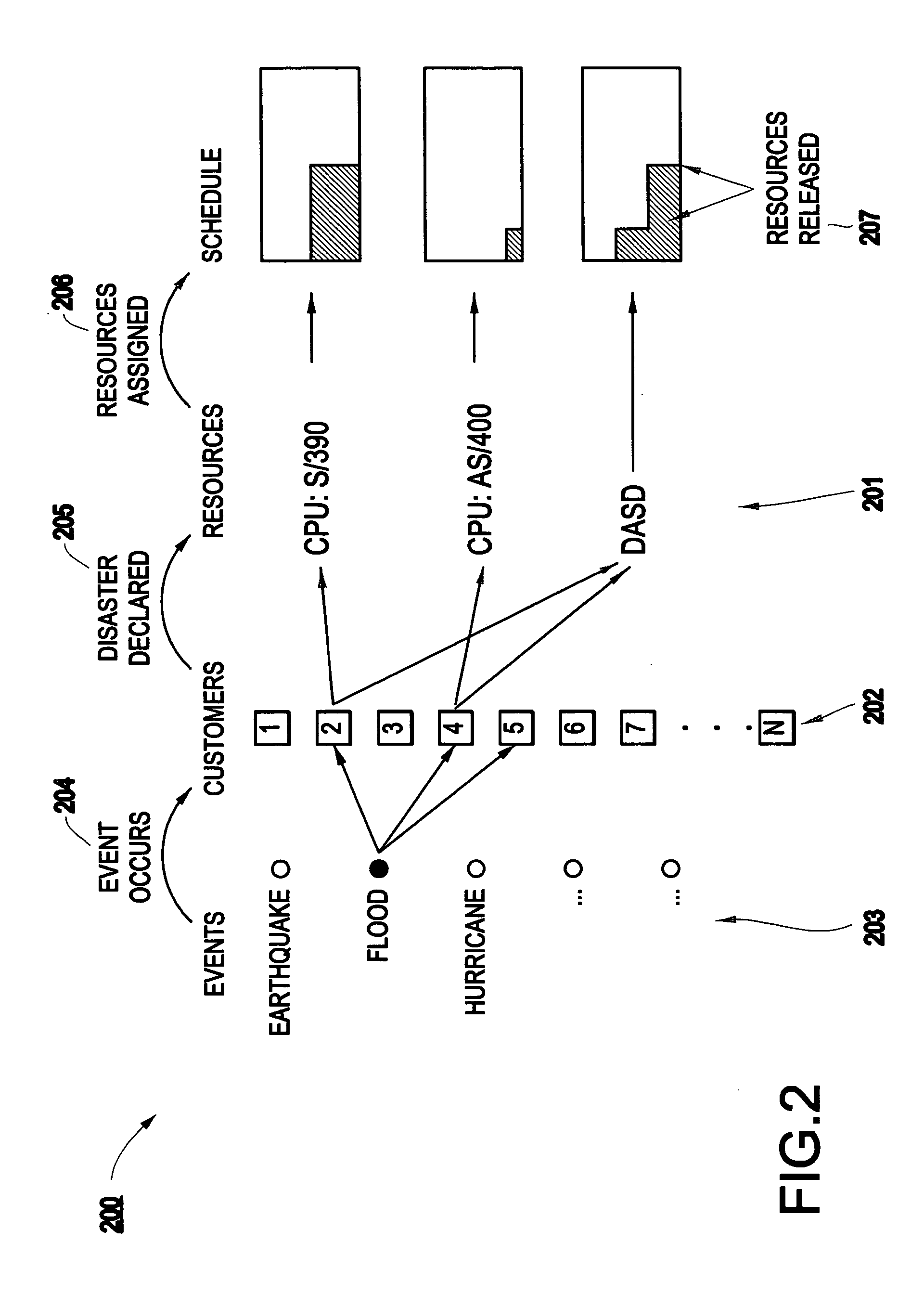

Method and apparatus for risk assessment for a disaster recovery process

InactiveUS20050027571A1Improve abilitiesGreat level of customer satisfactionFinanceElectric/magnetic detectionRisk exposureRisk model

A method and structure for calculating a risk exposure for a disaster recovery process, including loading a user interface into a memory, the user interface allowing control of an execution of one or more risk models. Each risk model is based on a specific disaster type, and each risk model addresses a recovery utilization of one or more specific assets identified as necessary for a recovery process of the disaster type. One of the risk models is executed at least one time.

Owner:IBM CORP

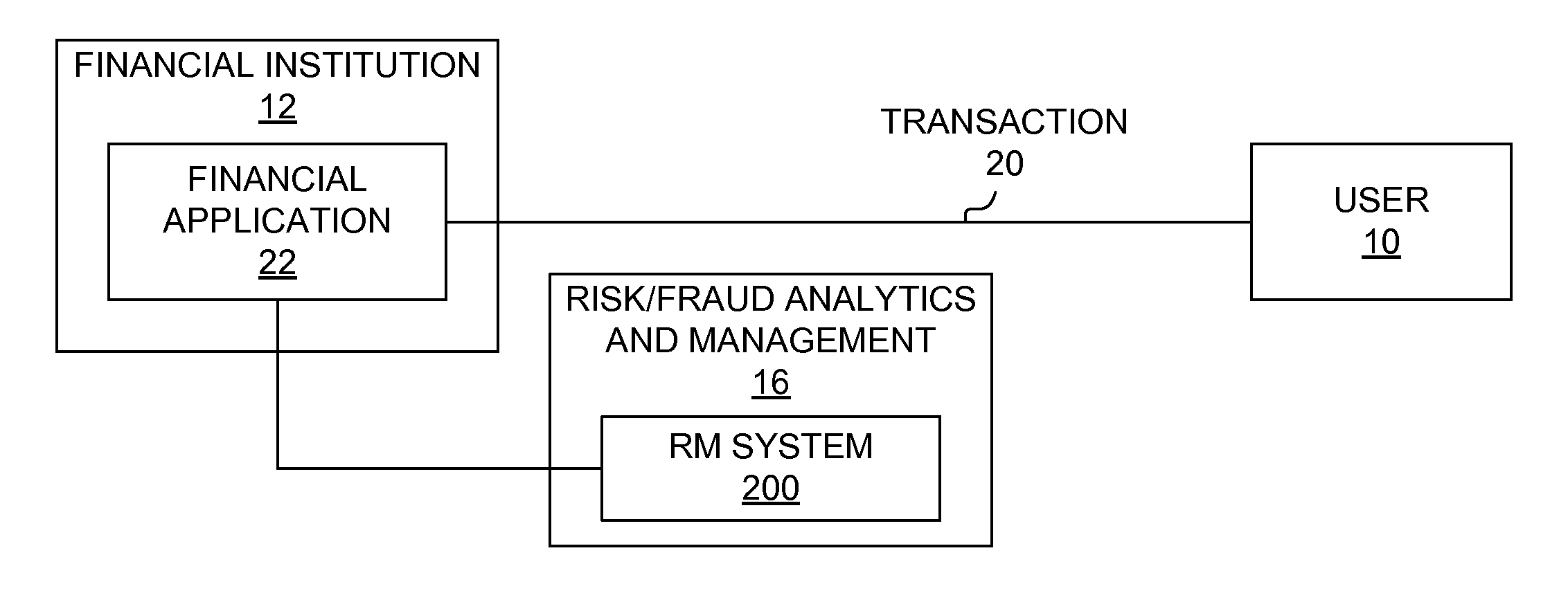

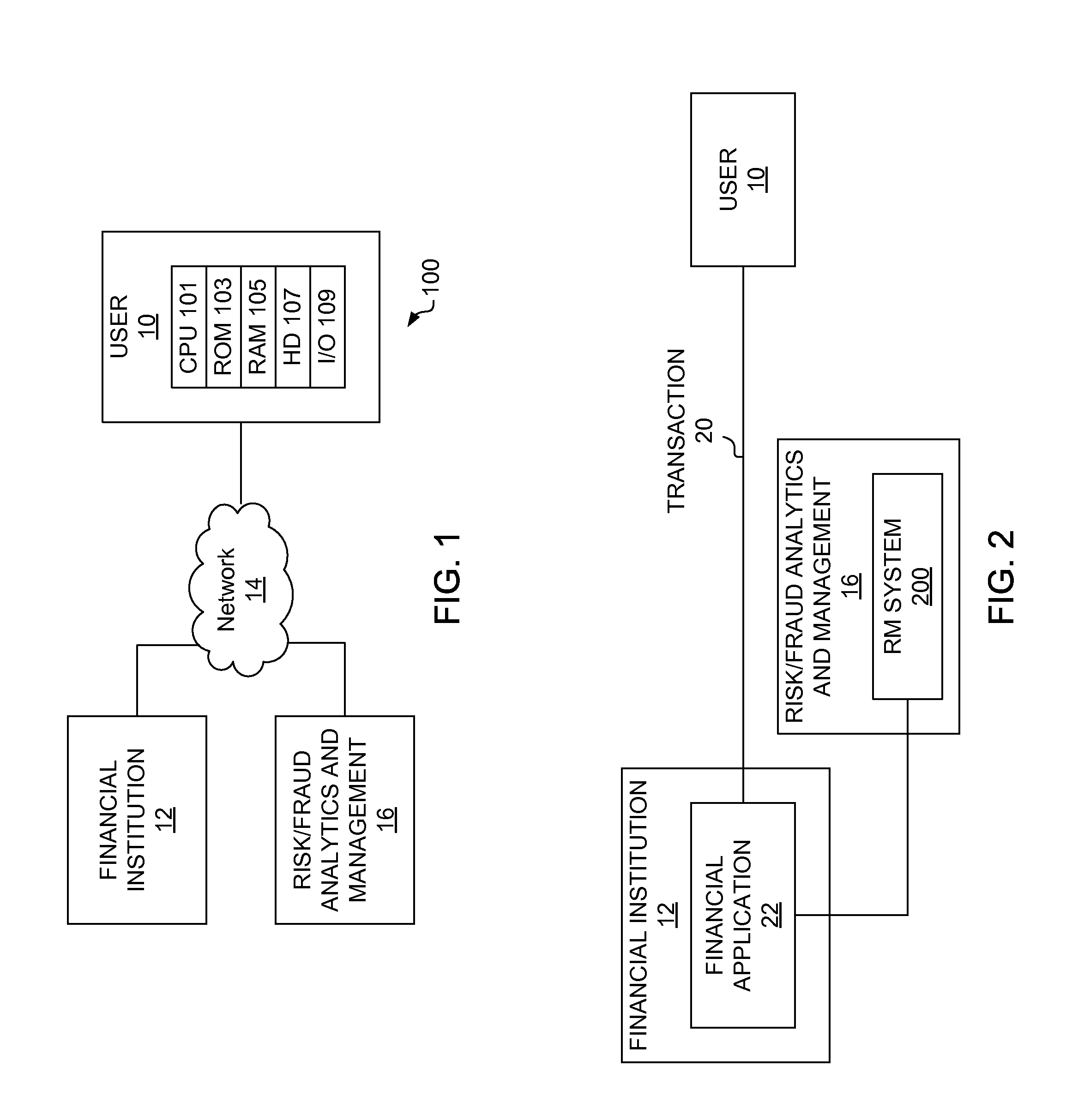

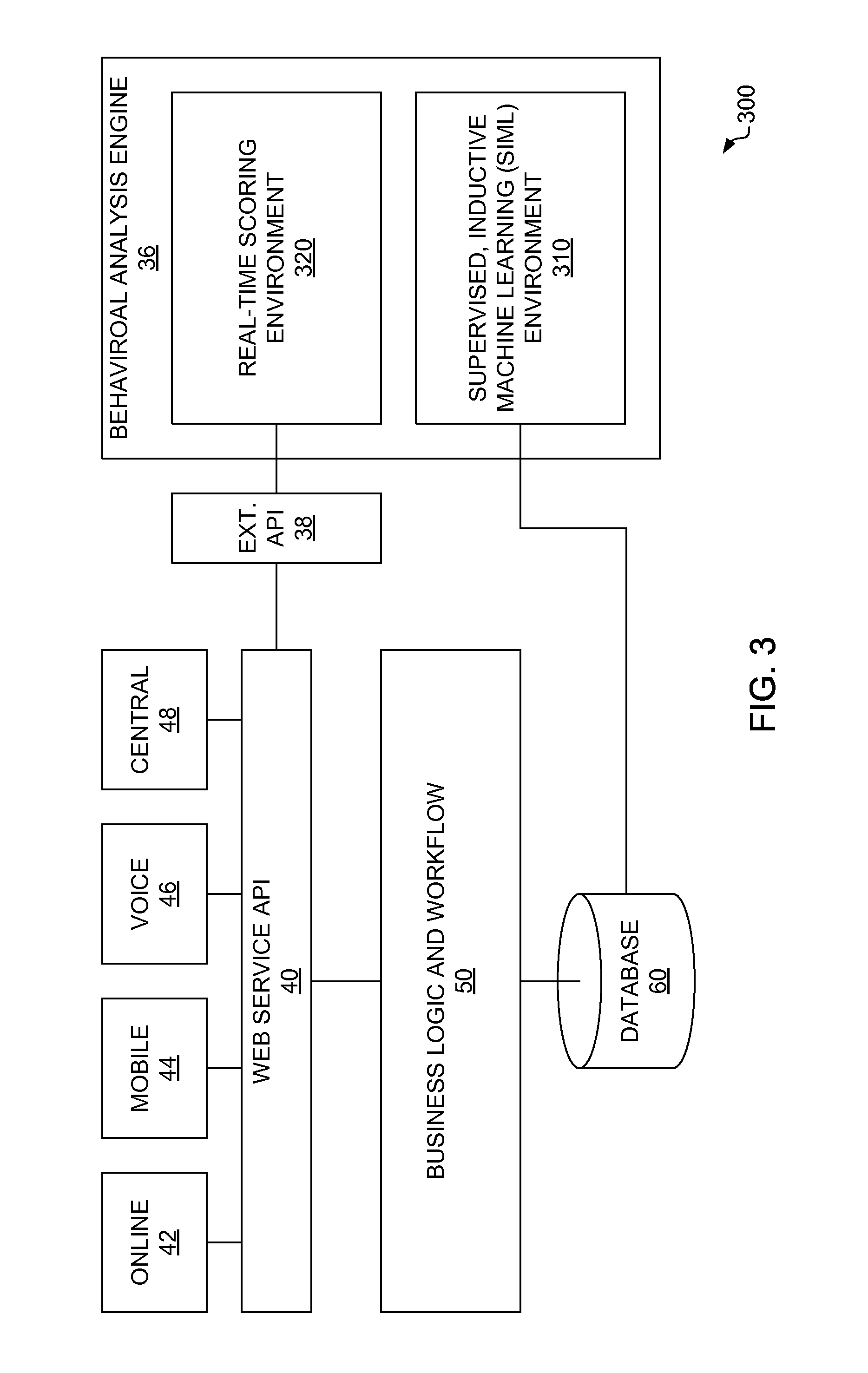

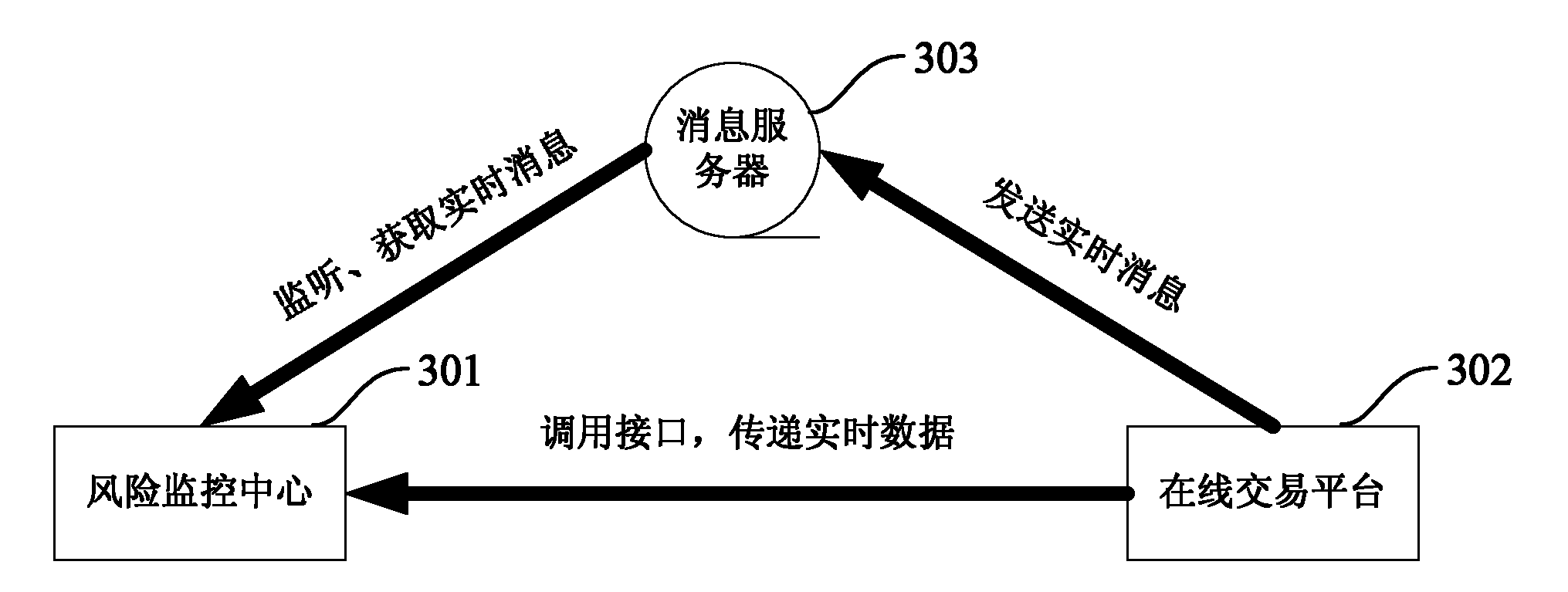

System, method and computer program product for real-time online transaction risk and fraud analytics and management

InactiveUS20120109821A1Difficult to compromiseEliminate “ visibility gap ”FinancePayment architectureAtomic elementRisk model

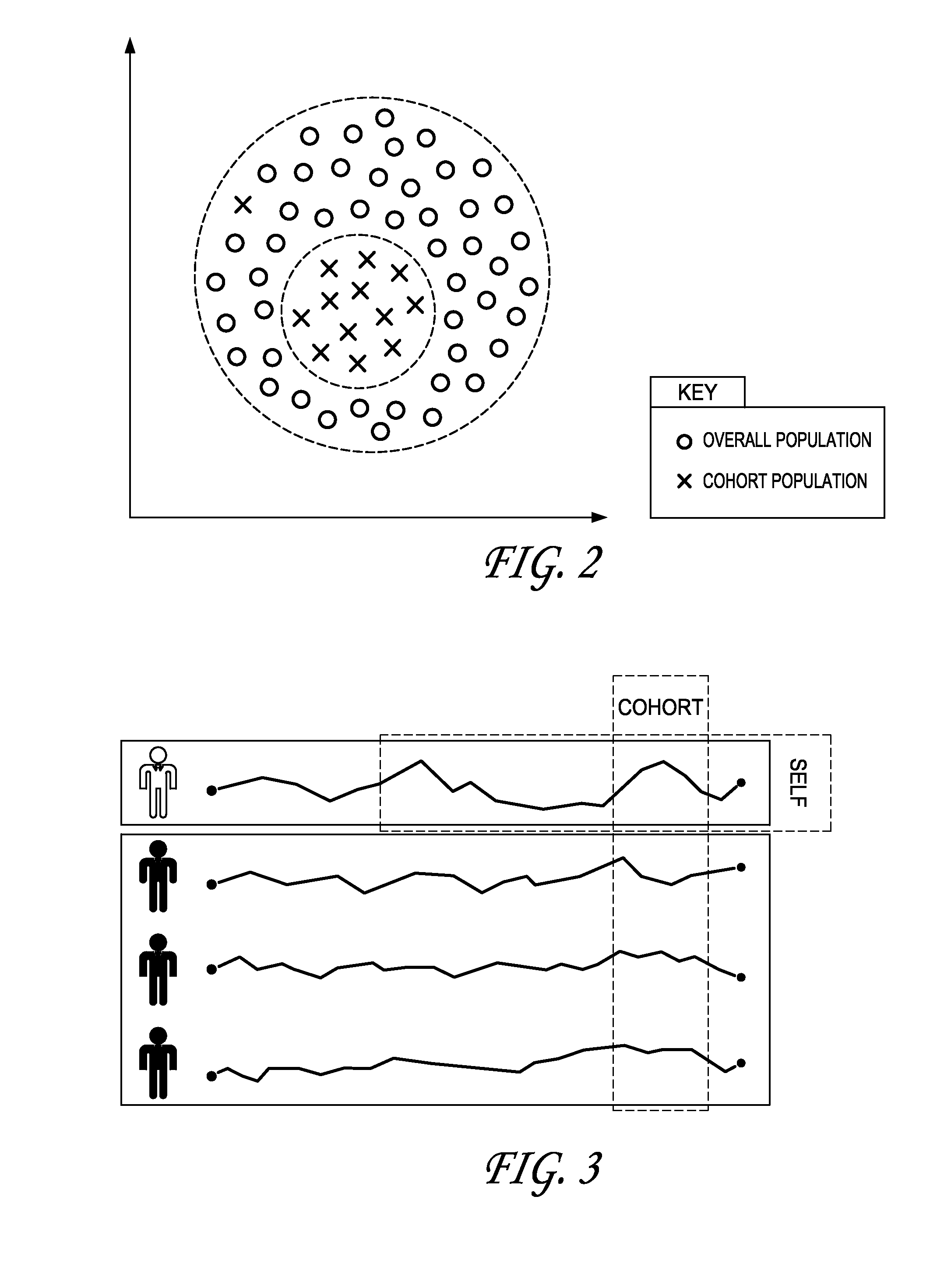

Embodiments disclosed herein provide a behavioral based solution to user identity validation, useful in real-time detection of abnormal activity while a user is engaged in an online transaction with a financial institution. A risk modeling system may run two distinct environments: one to train machine learning algorithms to produce classification objects and another to score user activities in real-time using these classification objects. In both environments, activity data collected on a particular user is mapped to various behavioral models to produce atomic elements that can be scored. Classifiers may be dynamically updated in response to new behavioral activities. Example user activities may include login, transactional, and traverse. In some embodiments, depending upon configurable settings with respect to sensitivity and / or specificity, detection of an abnormal activity or activities may not trigger a flag-and-notify unless an attempt is made to move or transfer money.

Owner:Q2 SOFTWARE

Total structural risk model

InactiveUS20090222376A1Improve business satisfactionFinanceFinancial data processingBehavioral analytics

The present invention generally relates to financial data processing, and in particular it relates to credit scoring, consumer profiling, consumer behavior analysis and modeling. More specifically, it relates to risk modeling using the inputs of credit bureau data, size of wallet data, and, optionally, internal data.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

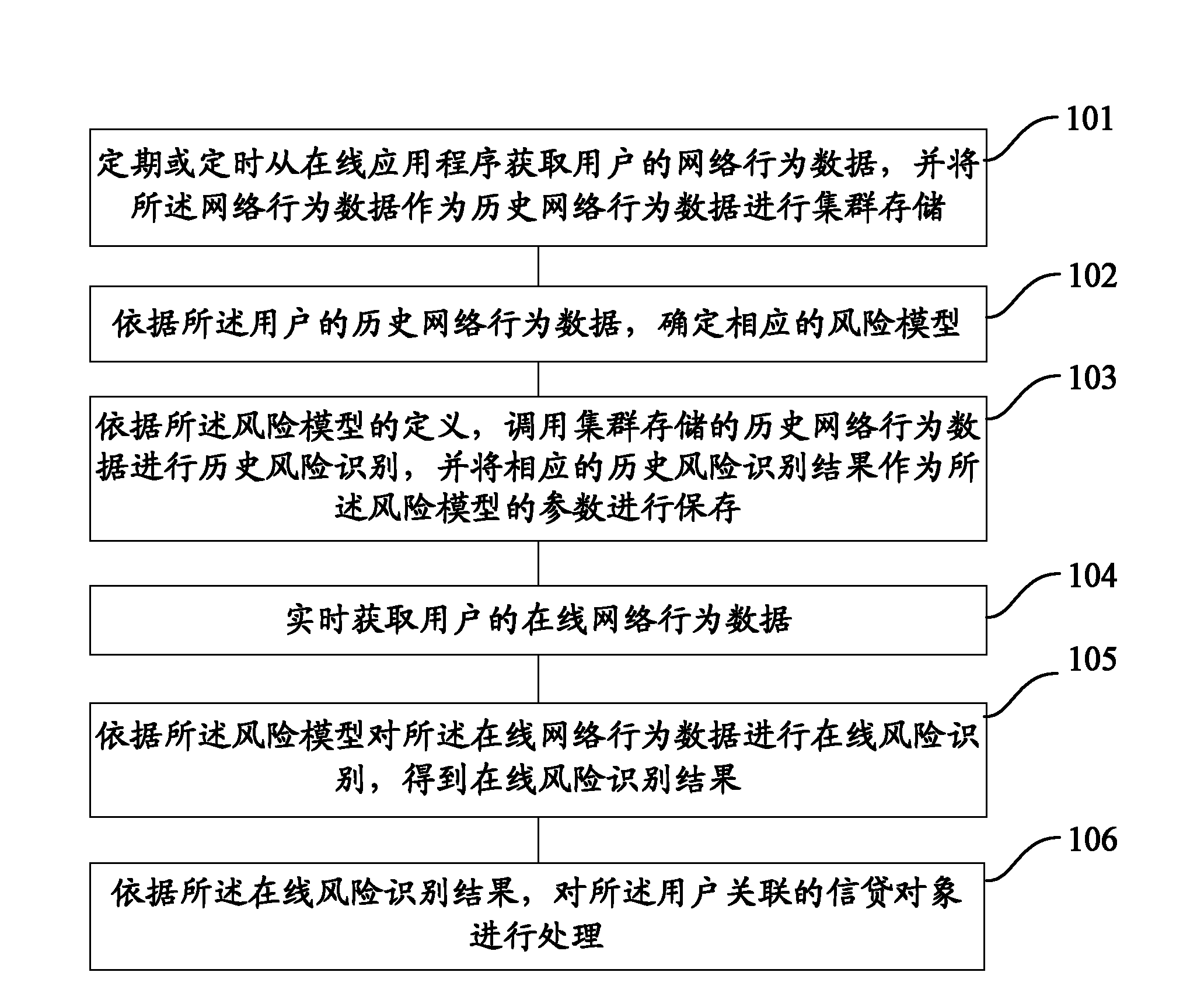

Method and system for monitoring network behavior data

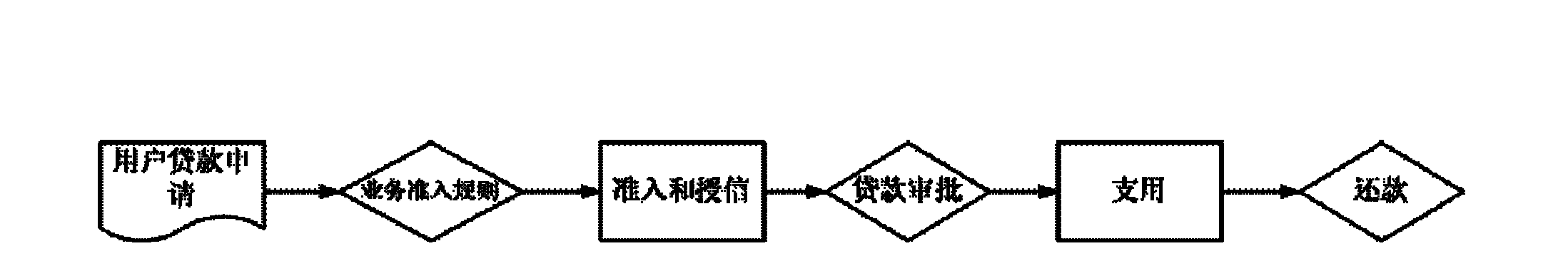

The invention provides a method and system for monitoring network behavior data. The method particularly comprises the steps of: obtaining network behavior data of a user from an online application program periodically or regularly, and regarding the network behavior data as historical network behavior data for collective storage; determining a corresponding risk model based on the historical network behavior data of the user; calling the collectively stored historical network behavior data for historical risk identification based on the definition of the risk model, and regarding a corresponding historical risk identification result as a parameter of the risk model for storage; obtaining the online network behavior data of the user in real time; performing online risk identification on the online network behavior data based on the risk model so as to obtain an online risk identification result; and processing a credit object associated with the user based on the online risk identification result. The method and system for monitoring the network behavior data can improve timeliness and accuracy of credit risk monitoring.

Owner:ALIBABA GRP HLDG LTD

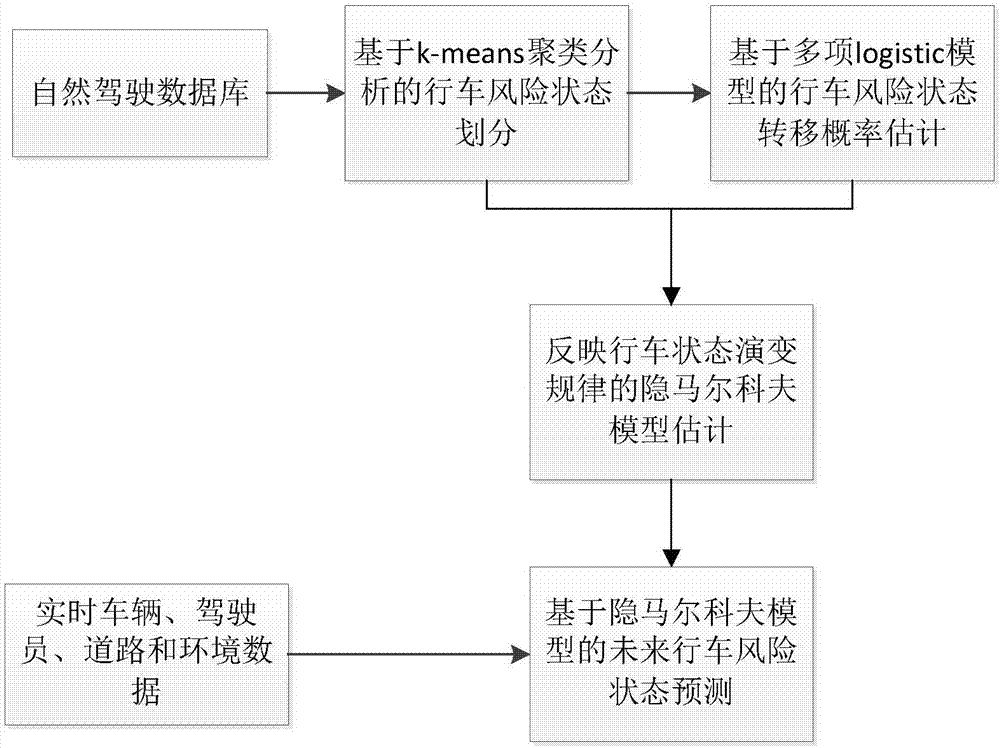

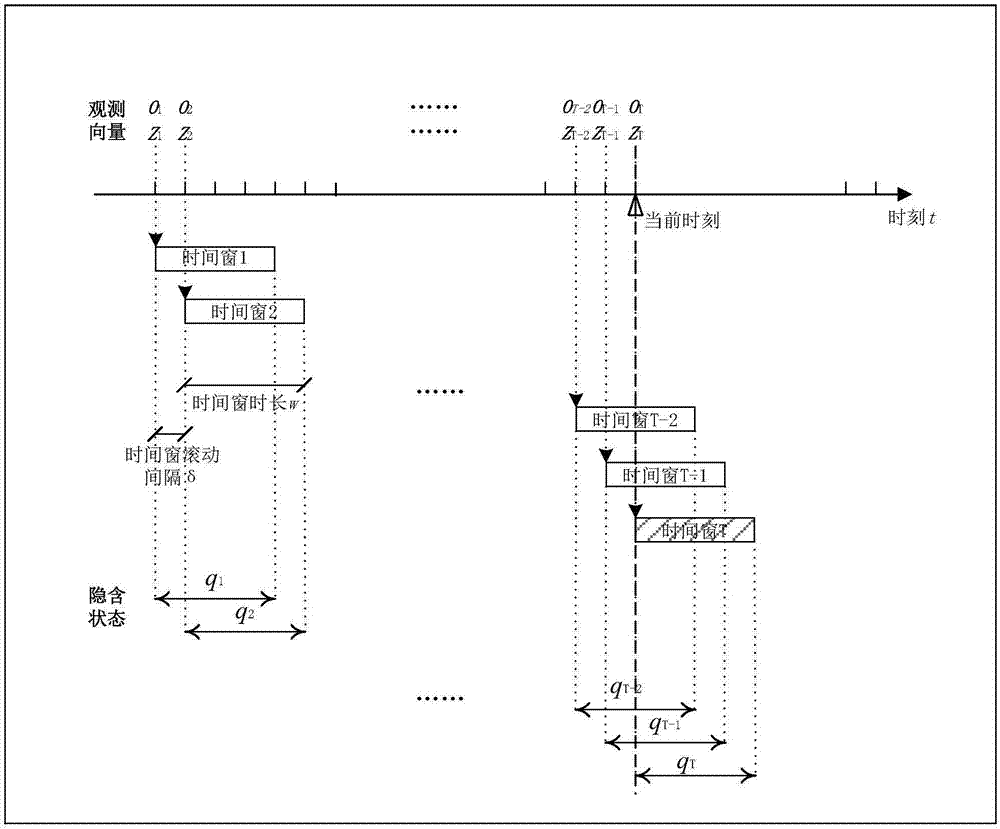

Prediction method of driving risk based on hidden Markov model

ActiveCN107958269AImprove accuracyImprove forecast accuracyData processing applicationsCharacter and pattern recognitionHidden markov chain modelRisk model

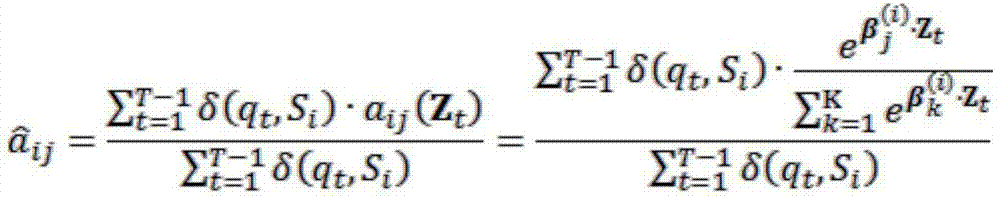

The invention discloses a prediction method of driving risk based on a hidden Markov model. The method comprises the steps of (1) classifying driving risk states through a cluster analysis method based on vehicle operating characteristics, (2) estimating the influences of a driver behavior and surrounding traffic environment characteristics on a transition probability between driving risk states through multiple logistical models for different driving risk states, (3) with a risk state as a hidden state, with an actual observed vehicle movement variable as a state output value, with multiple logistic model parameters as parameter initial values of a state transition probability matrix, establishing a hidden Markov chain model that reflects the evolution rule of driving states, and (4) obtaining the vehicle operating characteristics in real time and predicting a future risk state based on the hidden Markov chain model. According to the method, the hidden Markov model which can reflect the above characteristic real-time change and has a variable state transition probability is established, the accuracy and prediction accuracy of a driving risk model are improved, and the real-time requirements of anti-collision warning can be satisfied.

Owner:JIANGSU UNIV

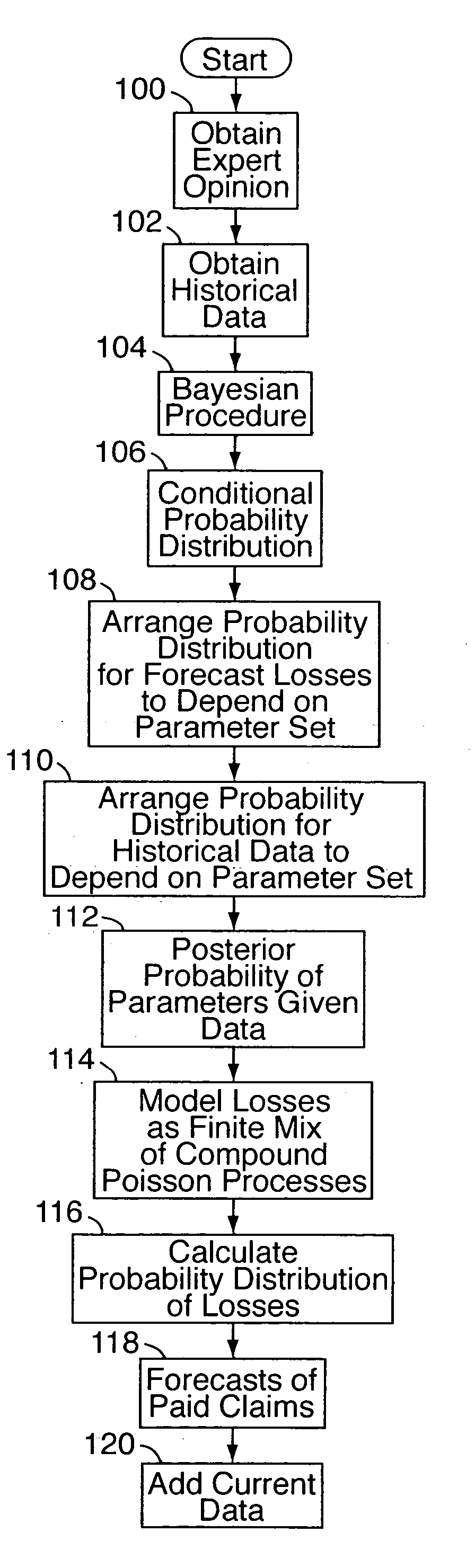

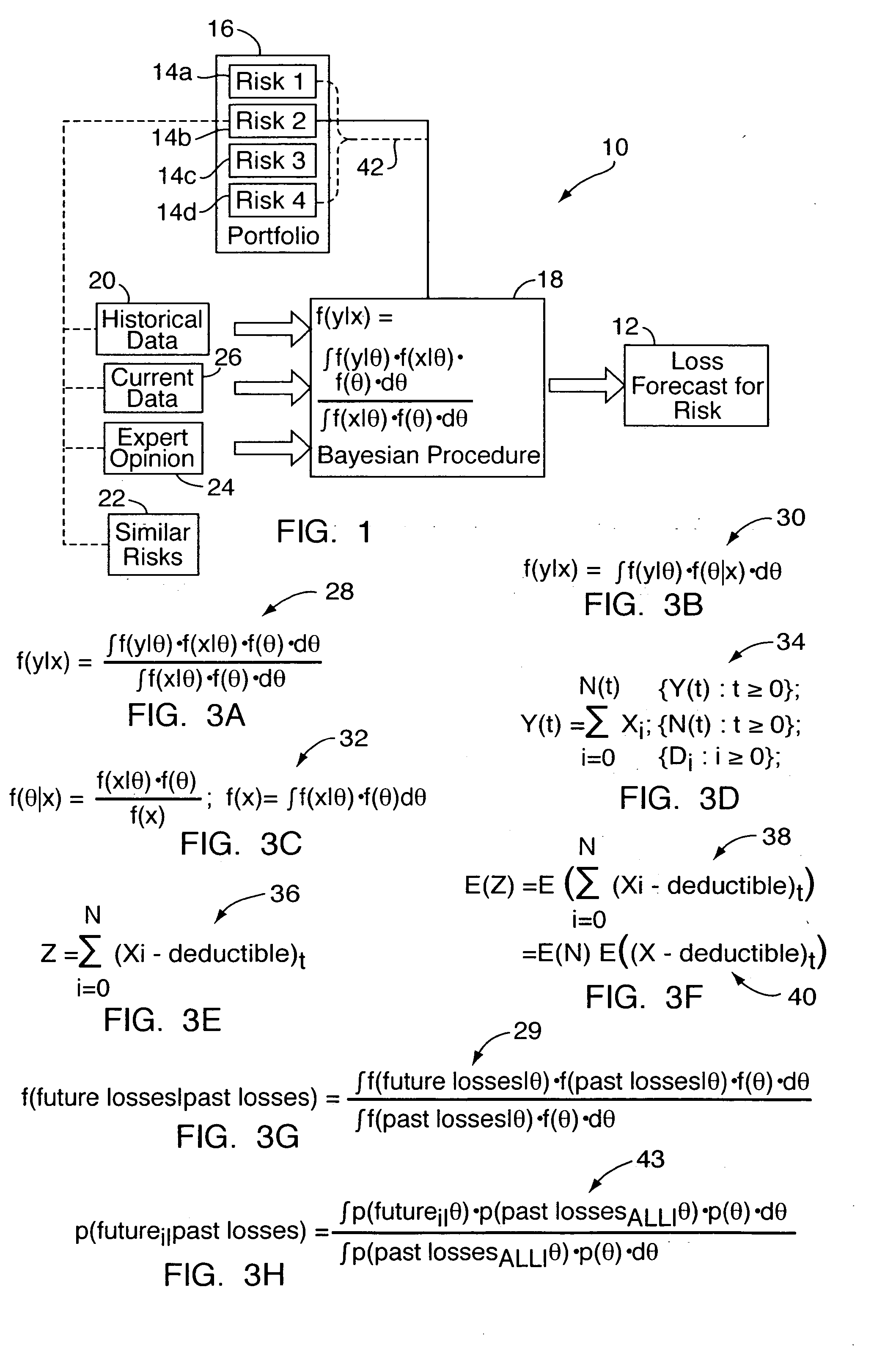

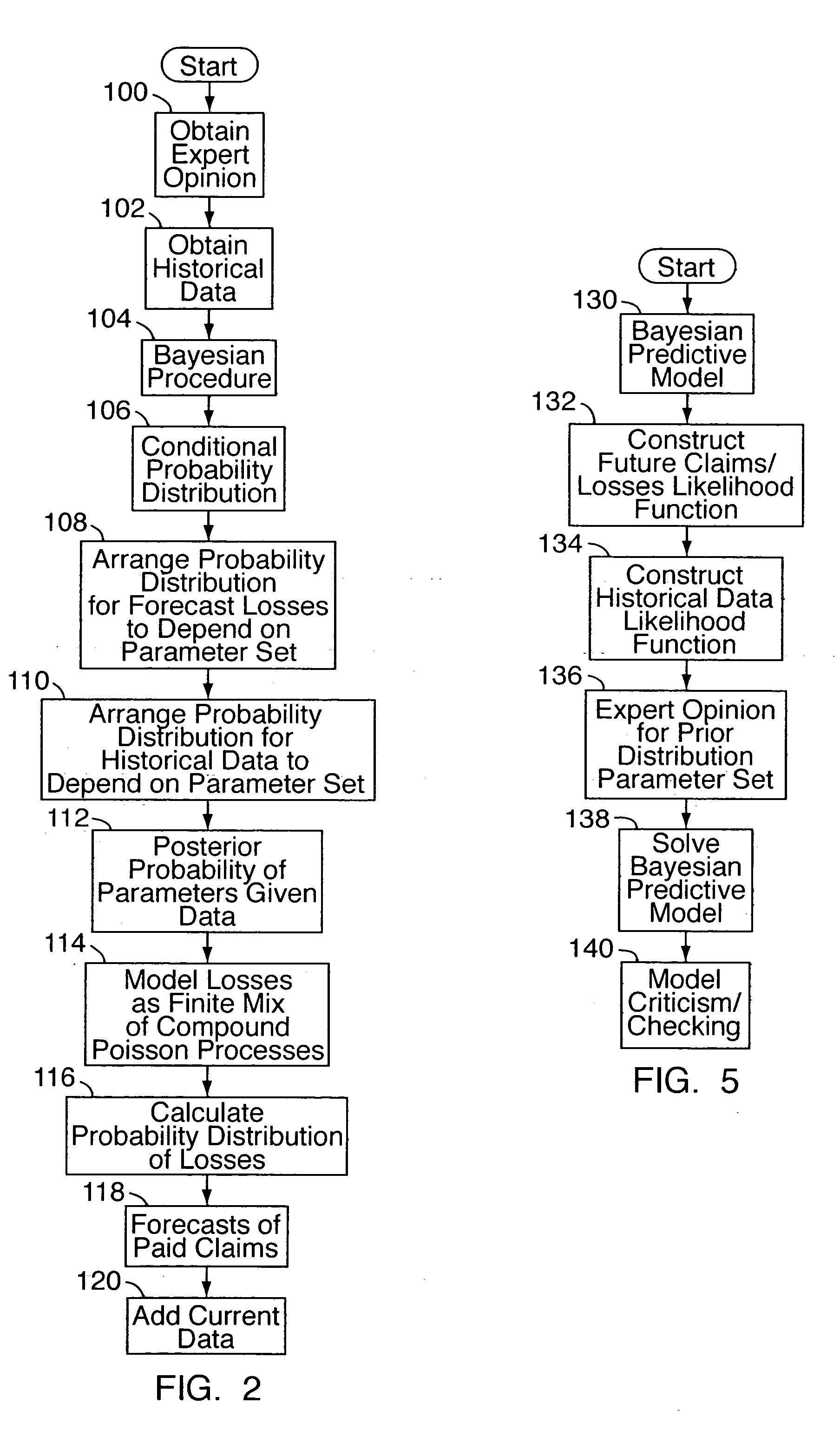

Method of determining prior net benefit of obtaining additional risk data for insurance purposes via survey or other procedure

A method is disclosed for determining the prior net benefit of obtaining data relating to an individual risk in an insurance portfolio, via a survey or similar procedure. A risk model is developed at the individual risk level for mathematically estimating the probability of expected loss given a set of information about the risk. The risk model is incorporated into a profitability model. A probability distribution relating to the type of survey information to be obtained is developed, which is used for determining the gross value of obtaining the information. The method produces as an output a quantitative estimation (e.g., dollar value) of the net benefit of obtaining survey data for the risk, calculated as the gross value of the survey less the survey's cost, where the benefit of the survey relates to a quantitative increase in predictive accuracy resulting from incorporating the survey data into the predictive model.

Owner:HARTFORD STEAM BOILER INSPECTION & INSURANCE COMPANY THE

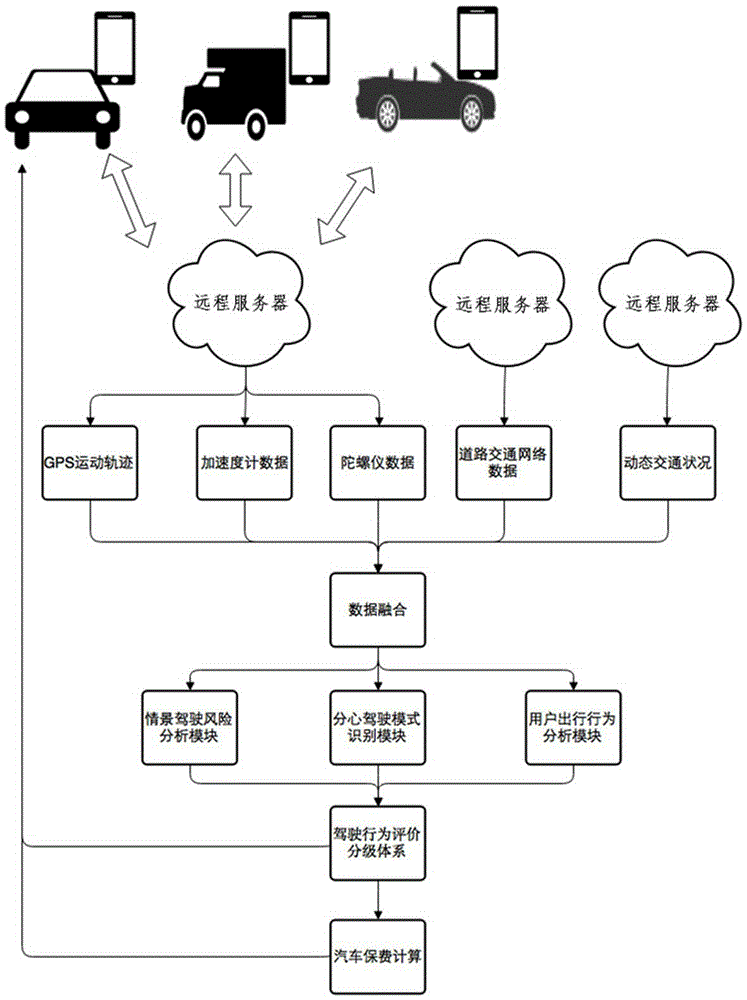

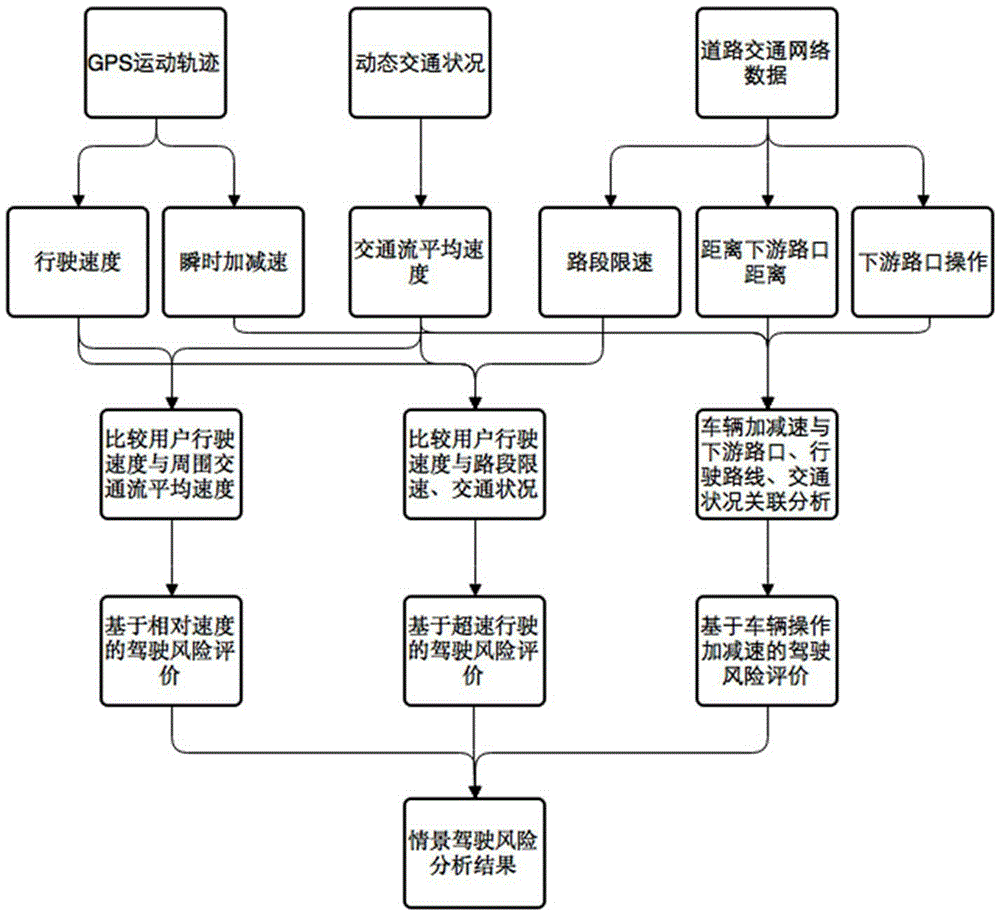

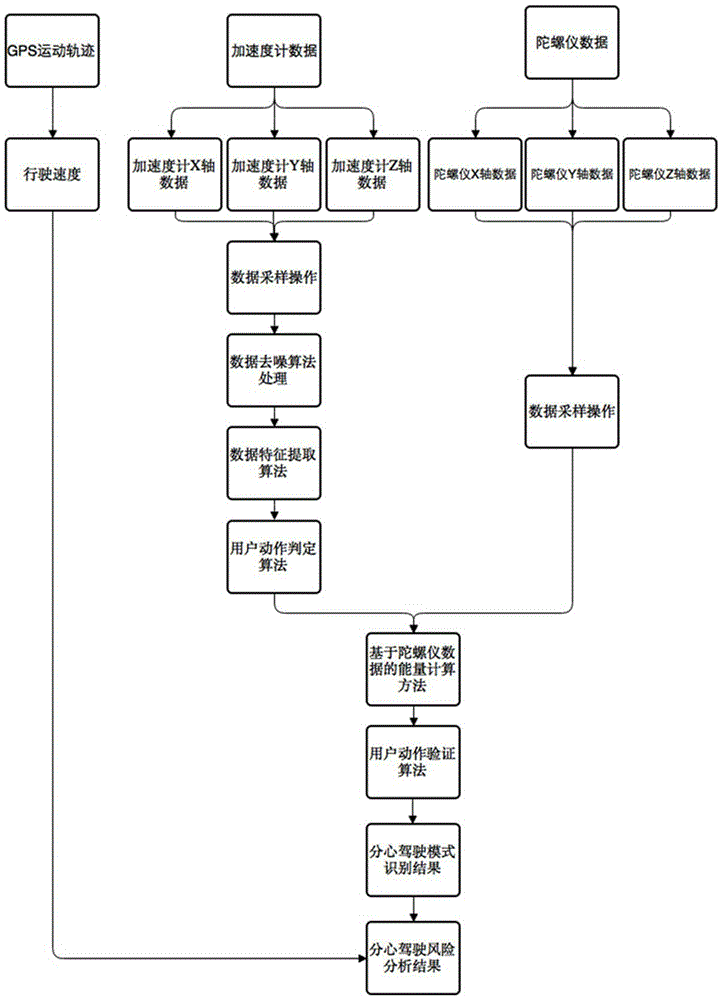

System and method for calculating driving risks and assisting automobile insurance pricing based on multi-source data

InactiveCN105374211AImprove traffic safetyReduce lossesDetection of traffic movementRisk modelData acquisition

The invention discloses a system and method for calculating driving risks and assisting automobile insurance pricing based on multi-source data. The system includes an intelligent mobile internet terminal and a remote server connected with each other; a plurality of data sensing acquisition units and applications are installed in the intelligent mobile terminal; and the remote server is provided with a risk model algorithm system and includes a scene driving risk analysis sub module, a distracted driving model recognition sub module, a user travel behavior analysis sub module and a driving behavior evaluation and grading system sub module. According to the system and method of the invention, data acquired by the intelligent mobile internet terminal and road traffic information acquired by the remote server are analyzed, and the scores of the sub modules are calculated, and automobile insurance pricing is carried out according to the scores. With the system and method of the invention adopted, based on multi-source data acquisition and fusion, the driving behaviors of users are analyzed, and the travel habits, driving habits and driving risks of the drivers can be effectively calibrated, and therefore, theoretical basis and technical support can be provided for driving behavior-based automobile insurance pricing models.

Owner:MINCHI INFORMATION TECH SHANGHAI CO LTD

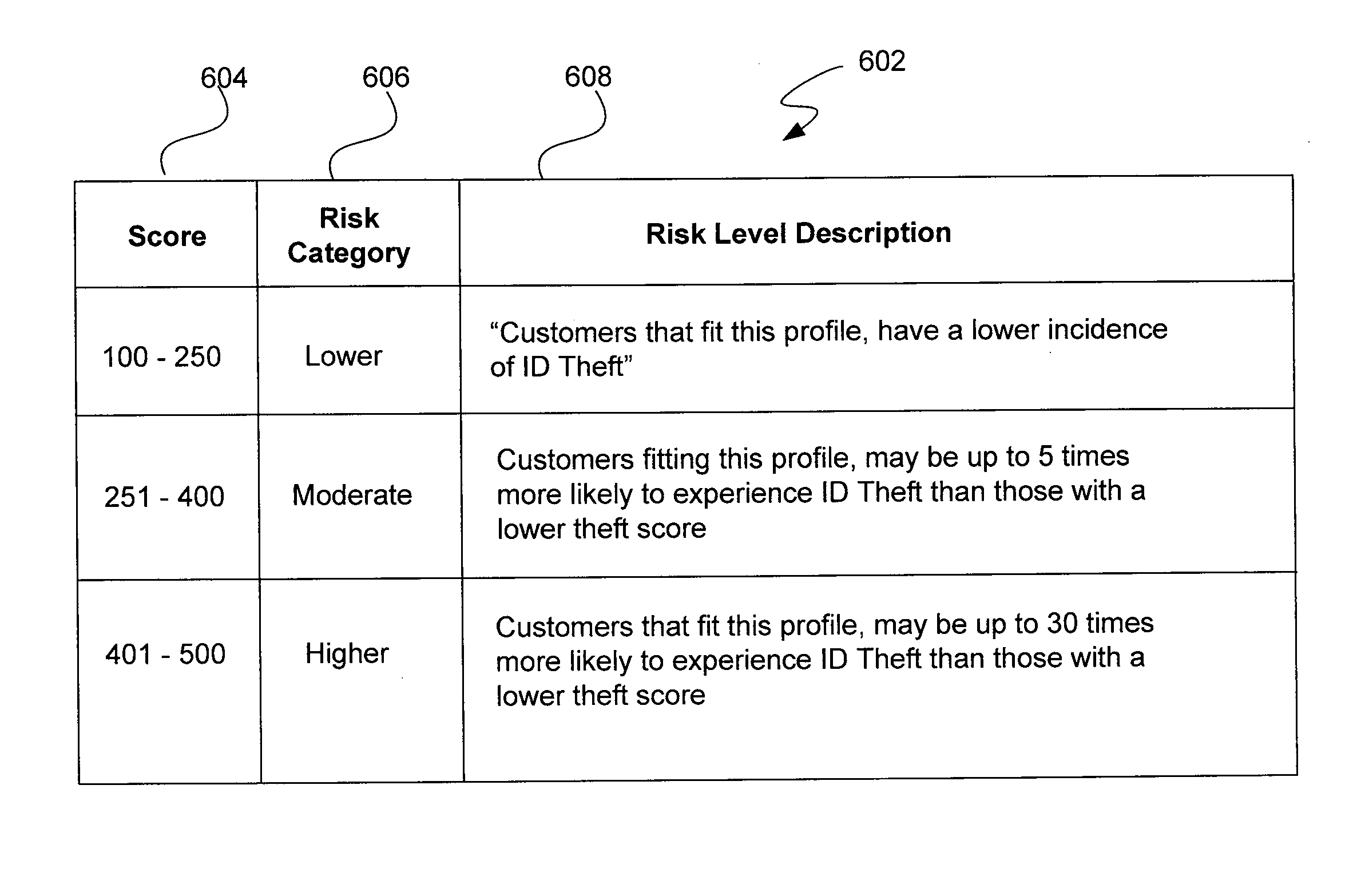

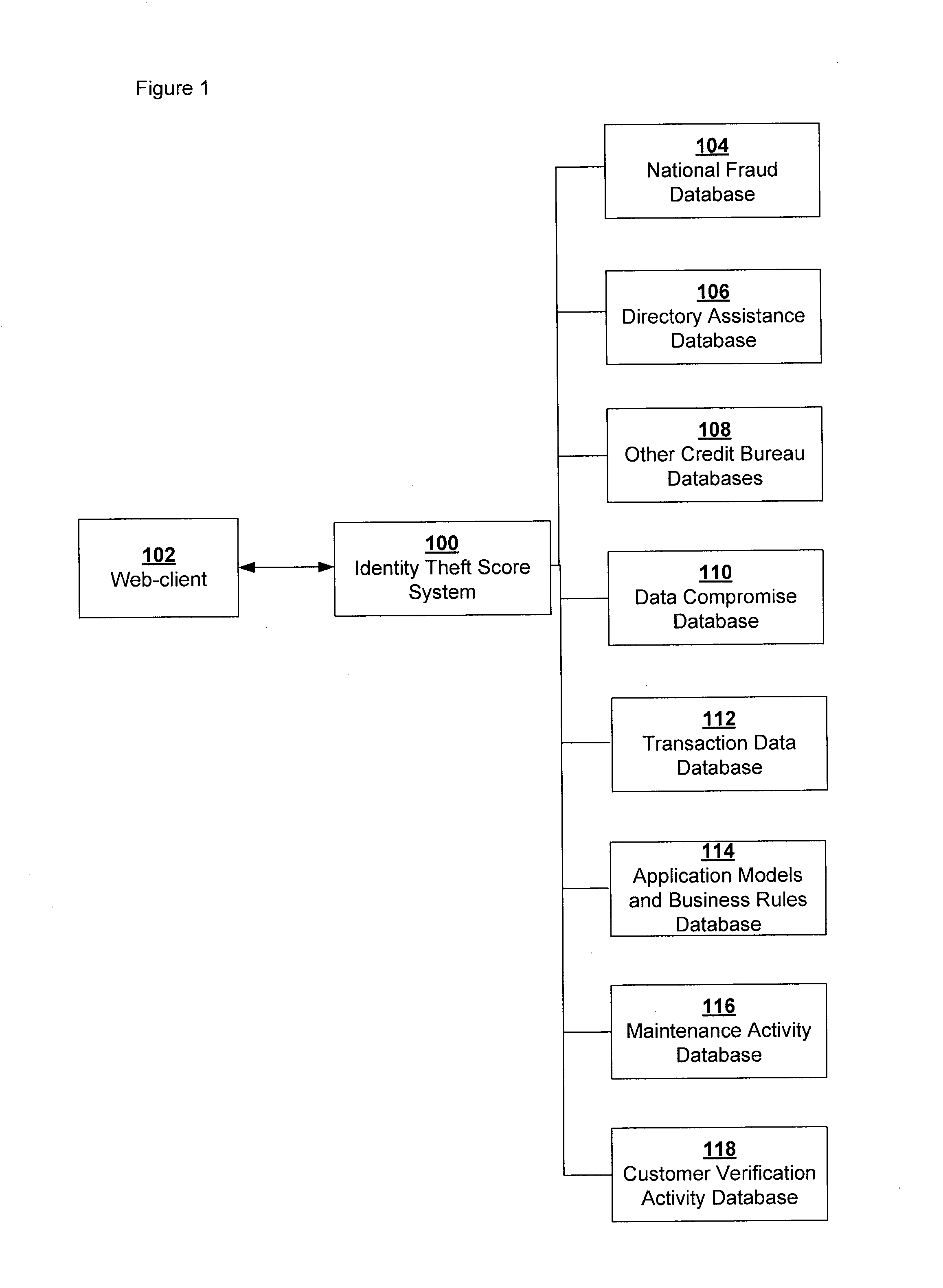

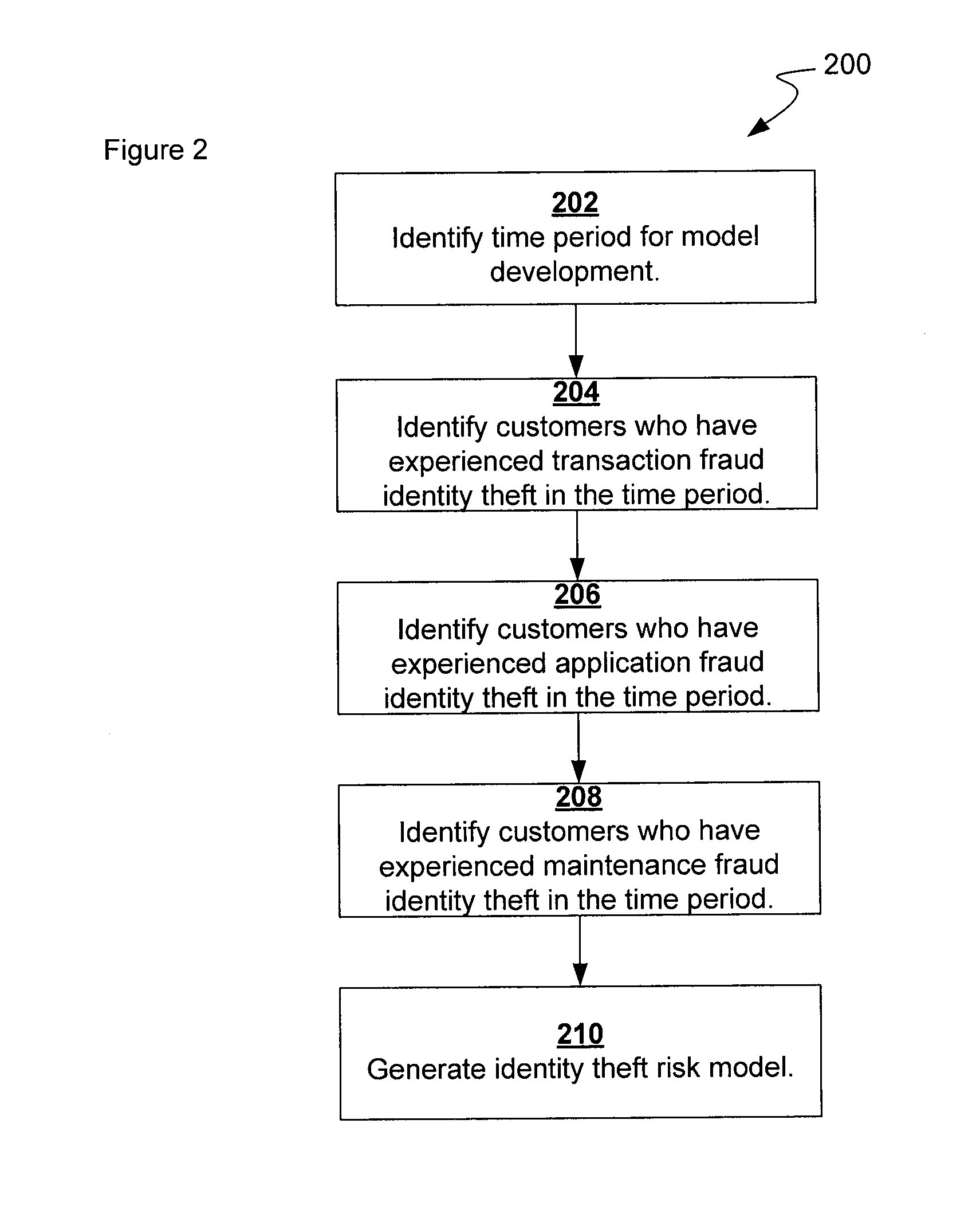

Generating an Identity Theft Score

A system for generating an identity theft score is disclosed. The system may identify consumers who have experienced identity theft during a historical time period, generate an identity theft risk model based upon the plurality of consumers who have experienced identity theft, and generate an identity theft score for an individual consumer based upon the identity theft risk model and data associated with the individual consumer. The identity theft risk model may comprise a regression model, and the identity theft score may represent a probability that the individual consumer will experience identity theft during a future time period.

Owner:LIBERTY PEAK VENTURES LLC

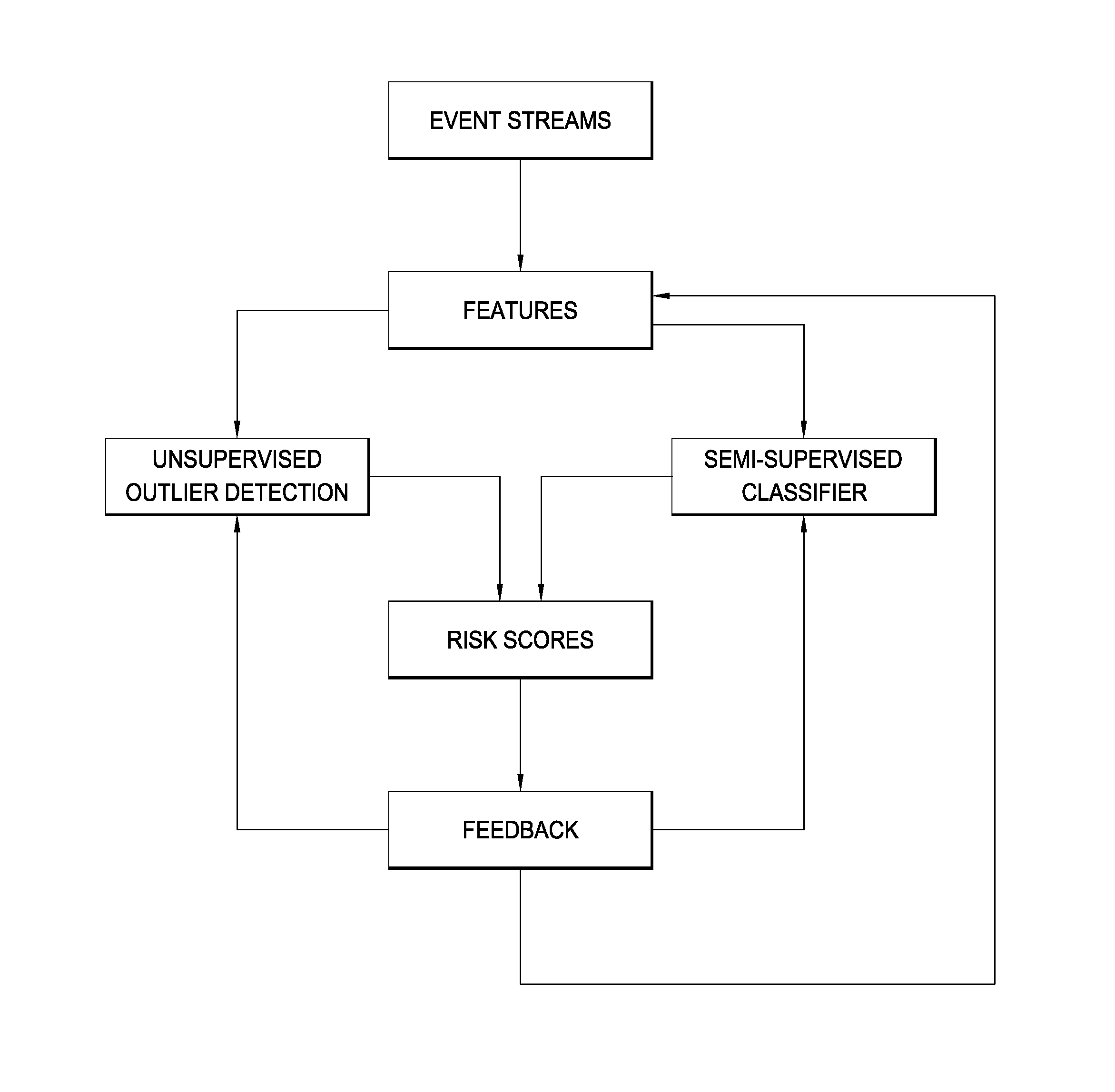

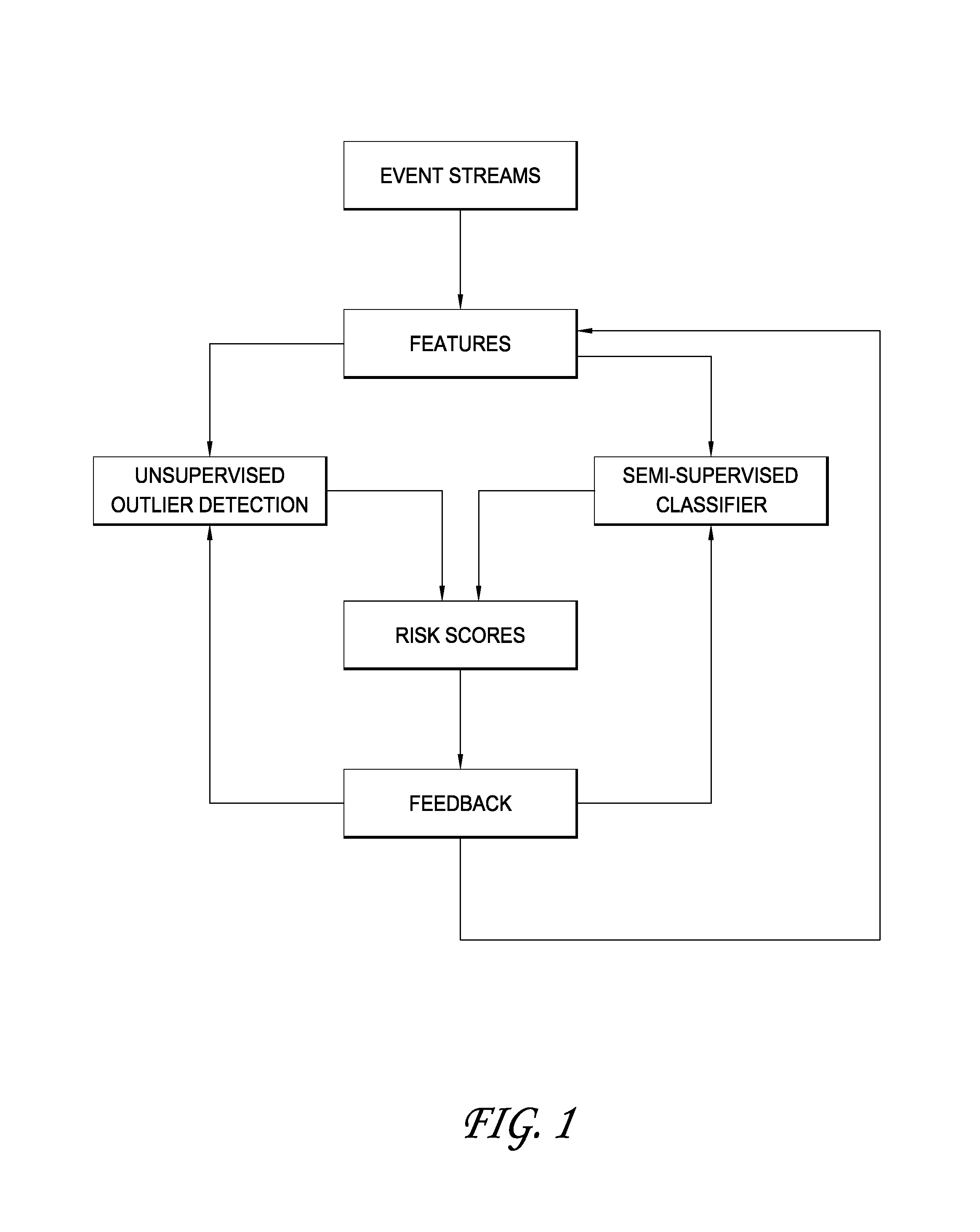

System and methods for detecting fraudulent transactions

InactiveUS20160253672A1Improve processing speedFunction increaseFinanceTransmissionProgram instructionRisk model

A computer system implements a risk model for detecting outliers in a large plurality of transaction data, which can encompass millions or billions of transactions in some instances. The computing system comprises a non-transitory computer readable storage medium storing program instructions for execution by a computer processor in order to cause the computing system to receive first features for an entity in the transaction data, receive second features for a benchmark set, the second features corresponding with the first features, determine an outlier value of the entity based on a Mahalanobis distance from the first features to a benchmark value representing an average for the second features. The output of the risk model can be used to prioritize review by a human data analyst. The data analyst's review of the underlying data can be used to improve the model.

Owner:PALANTIR TECHNOLOGIES

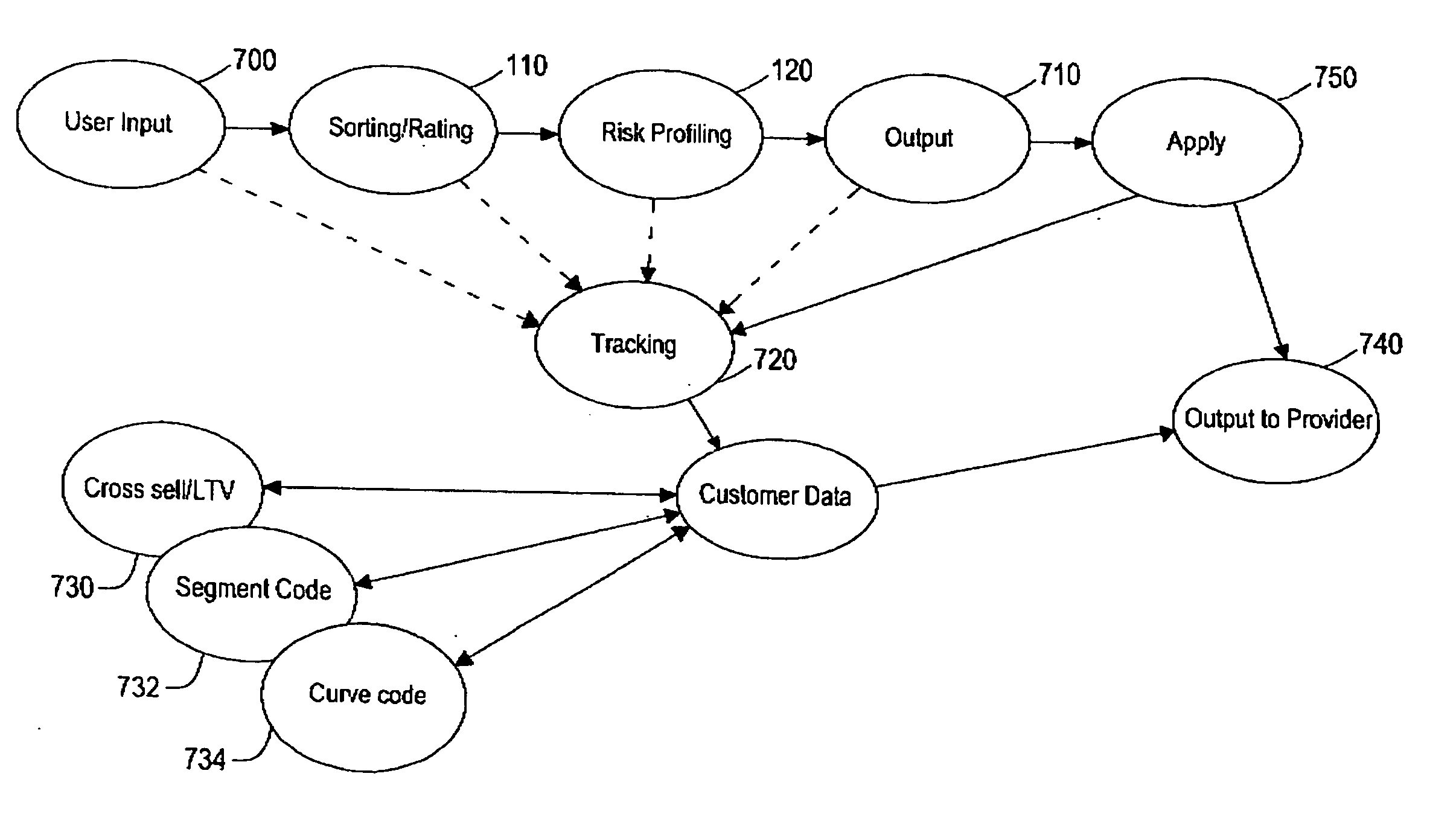

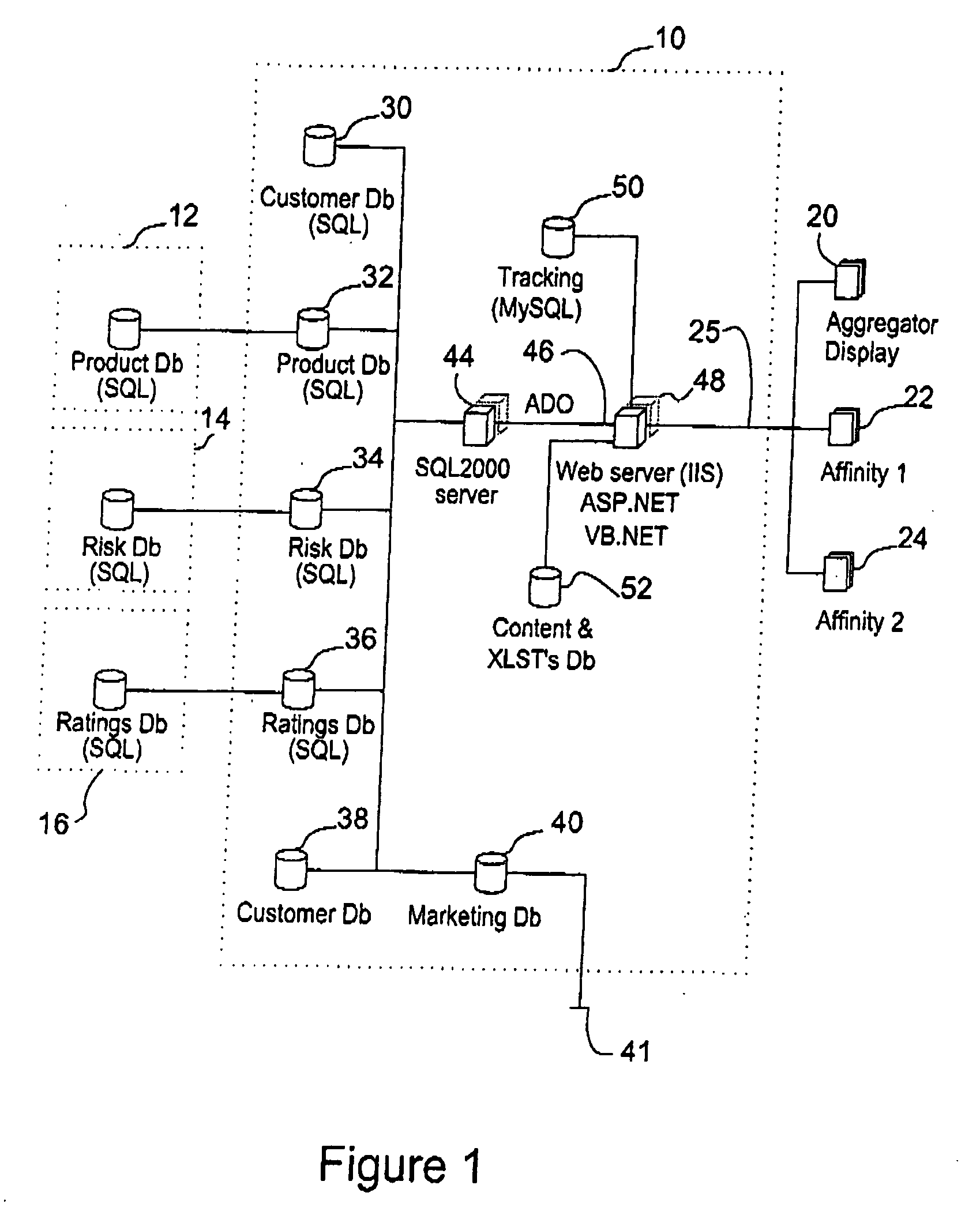

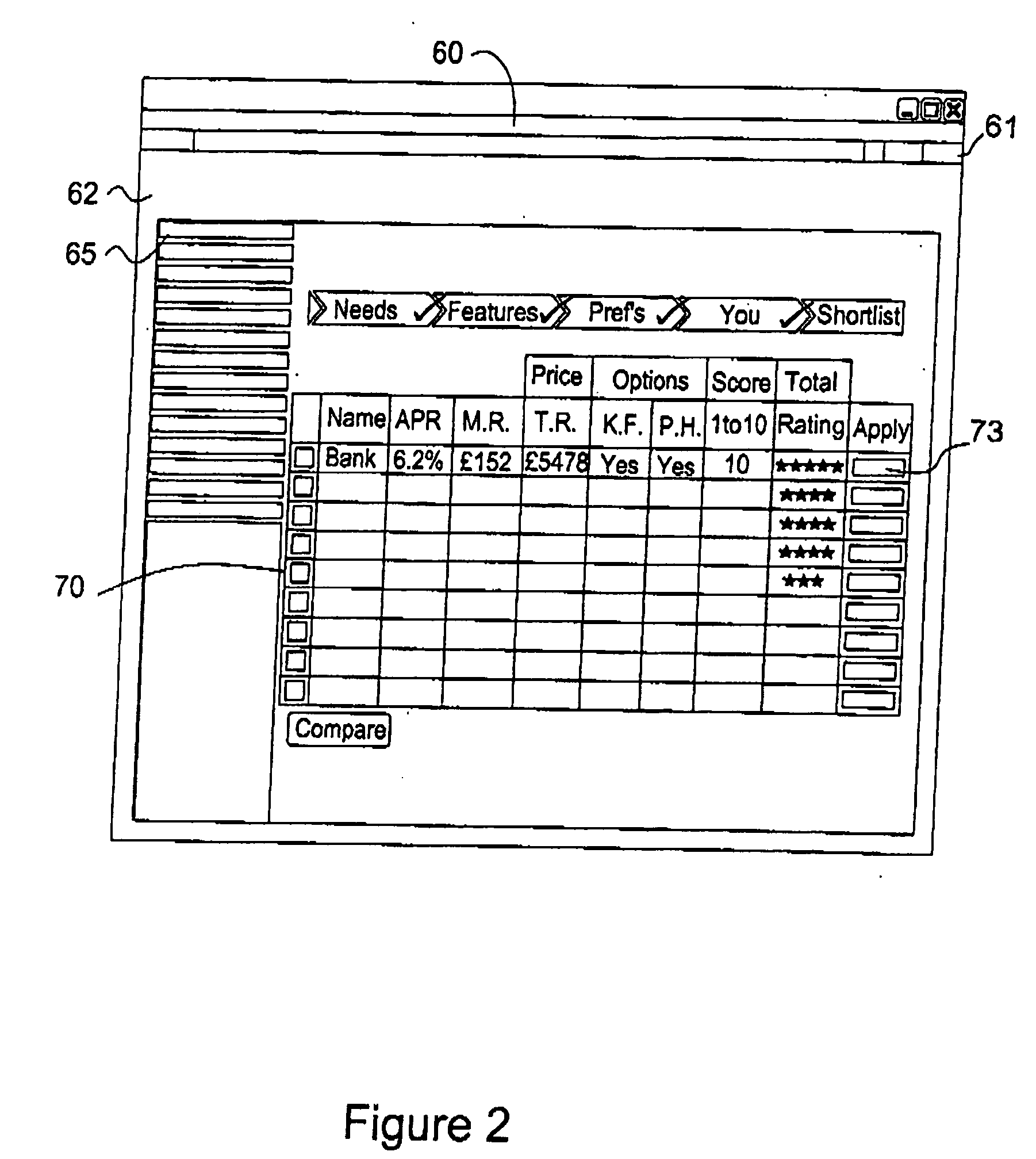

Information system with propensity modelling and profiling engine

InactiveUS20070050201A1Eliminate resultFinanceSpecial data processing applicationsRisk modelWeb service

An information system having various databases (30-40 and 50-52) for storing data relating to products or services, and risk data models or propensity models. A web server (48) provides web pages (20) through which a user is able to express choices, which result in querying the product database (32) to provide a raw result set, and filtering of the raw result set based on a risk model to eliminate results not having a likelihood of a successful outcome. The filtered result set is displayed. A propensity model database may be provided for storing data modelling the propensity of an outcome in relation to related products or services, e.g. based upon demographic or lifestyle data. A tracking tool may be used to define past behaviour of the user.

Owner:MONEYEXPERT

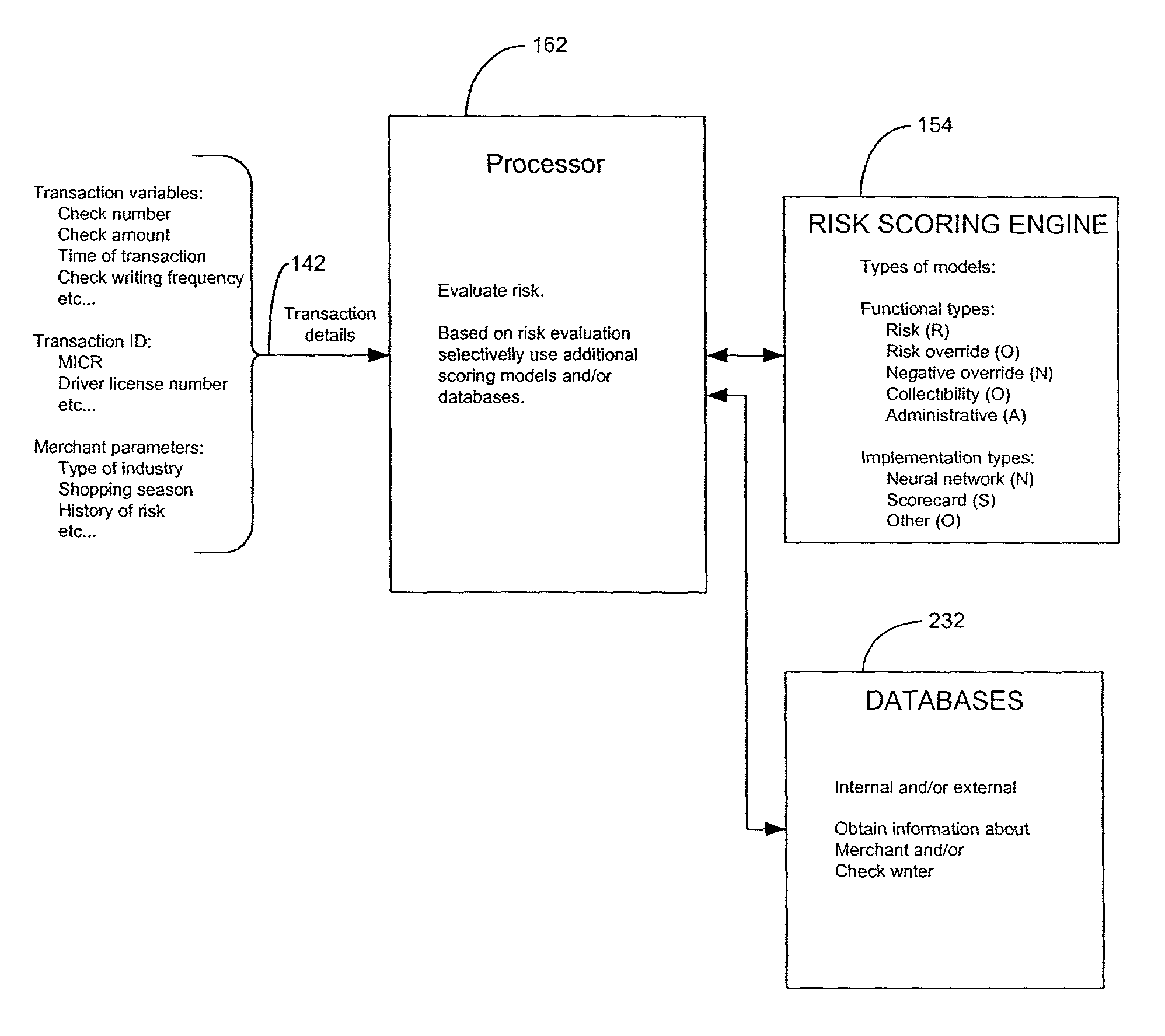

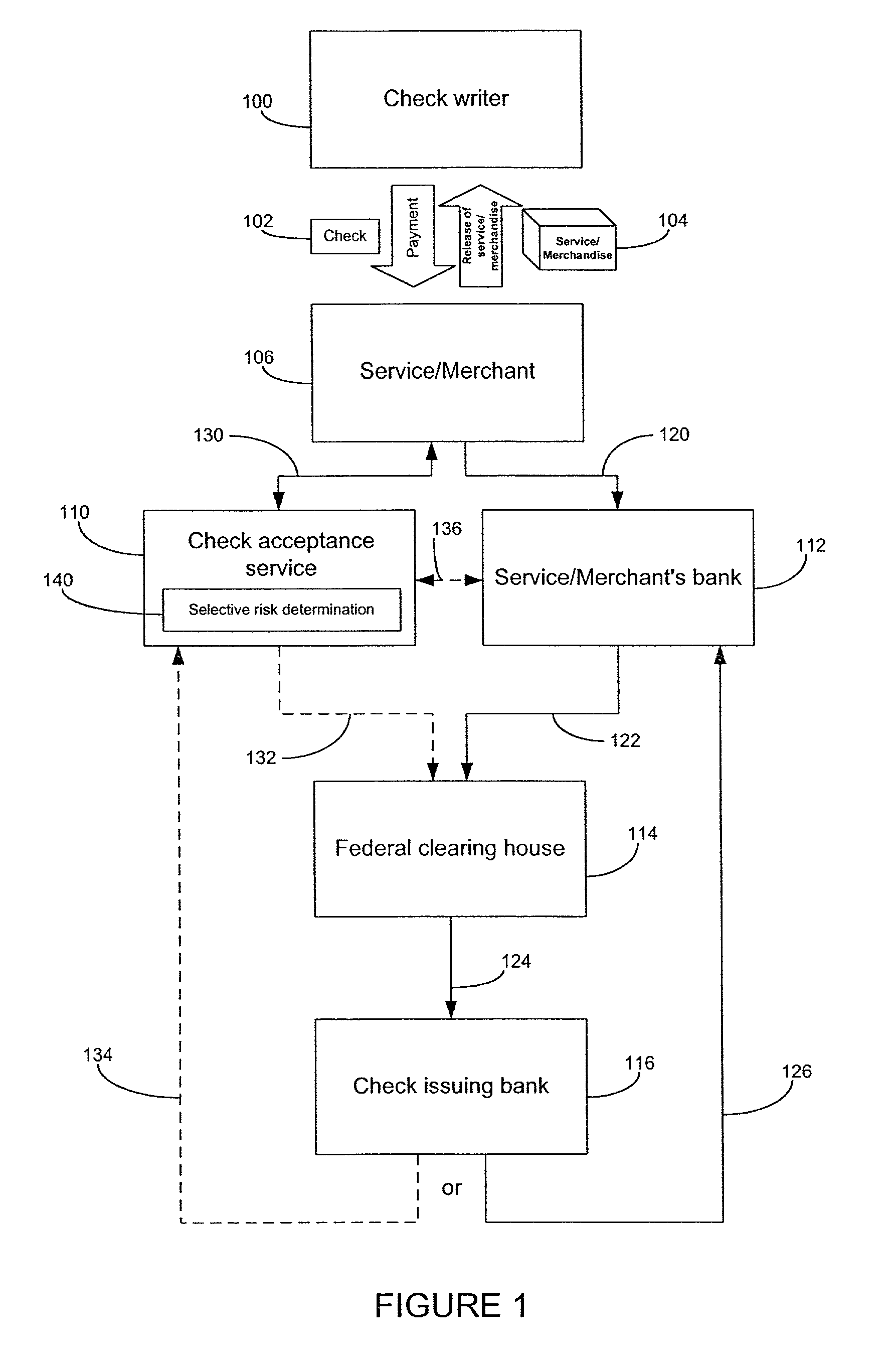

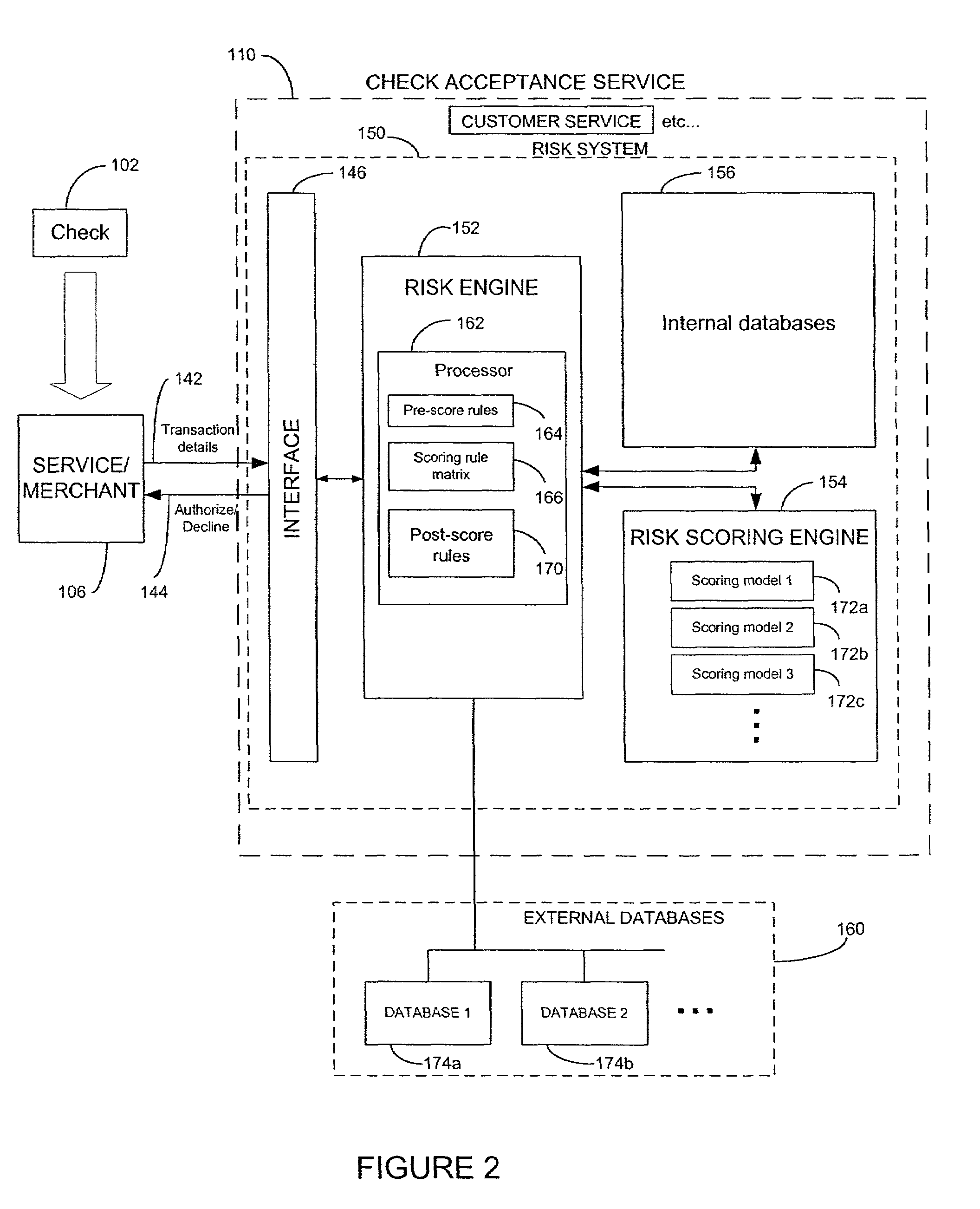

Systems and methods for selective use of risk models to predict financial risk

A risk system that performs a risk assessment of a financial transaction to obtain a first risk score, and based on first risk score performs post-score assessments by selectively utilizing various scoring models and databases. The post-score process re-assesses some of the borderline risks in order to capture beneficial transactions that may fail standard risk assessments that use a cutoff risk score to divide the transactions into either authorized or declined groups.

Owner:FIRST DATA

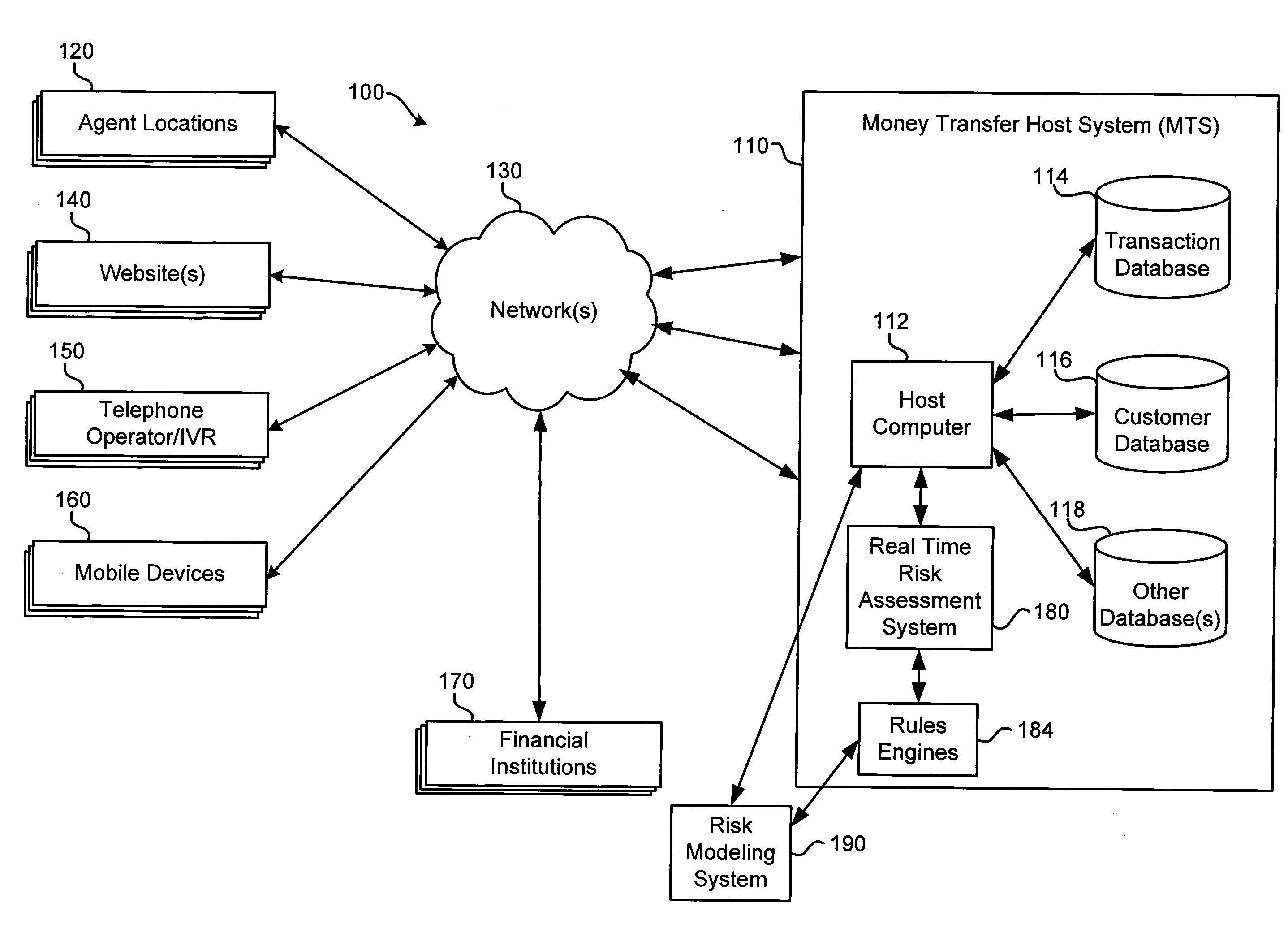

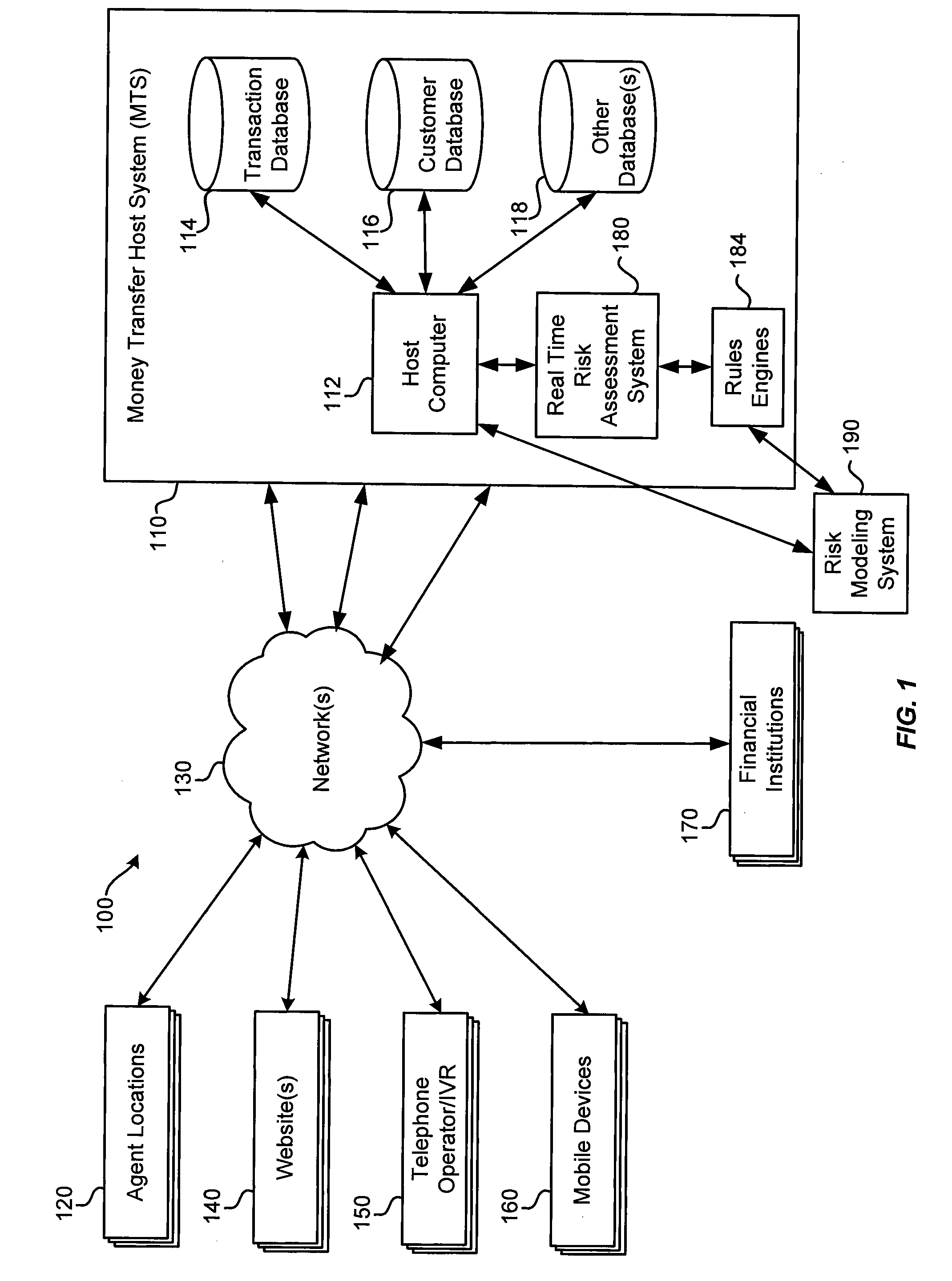

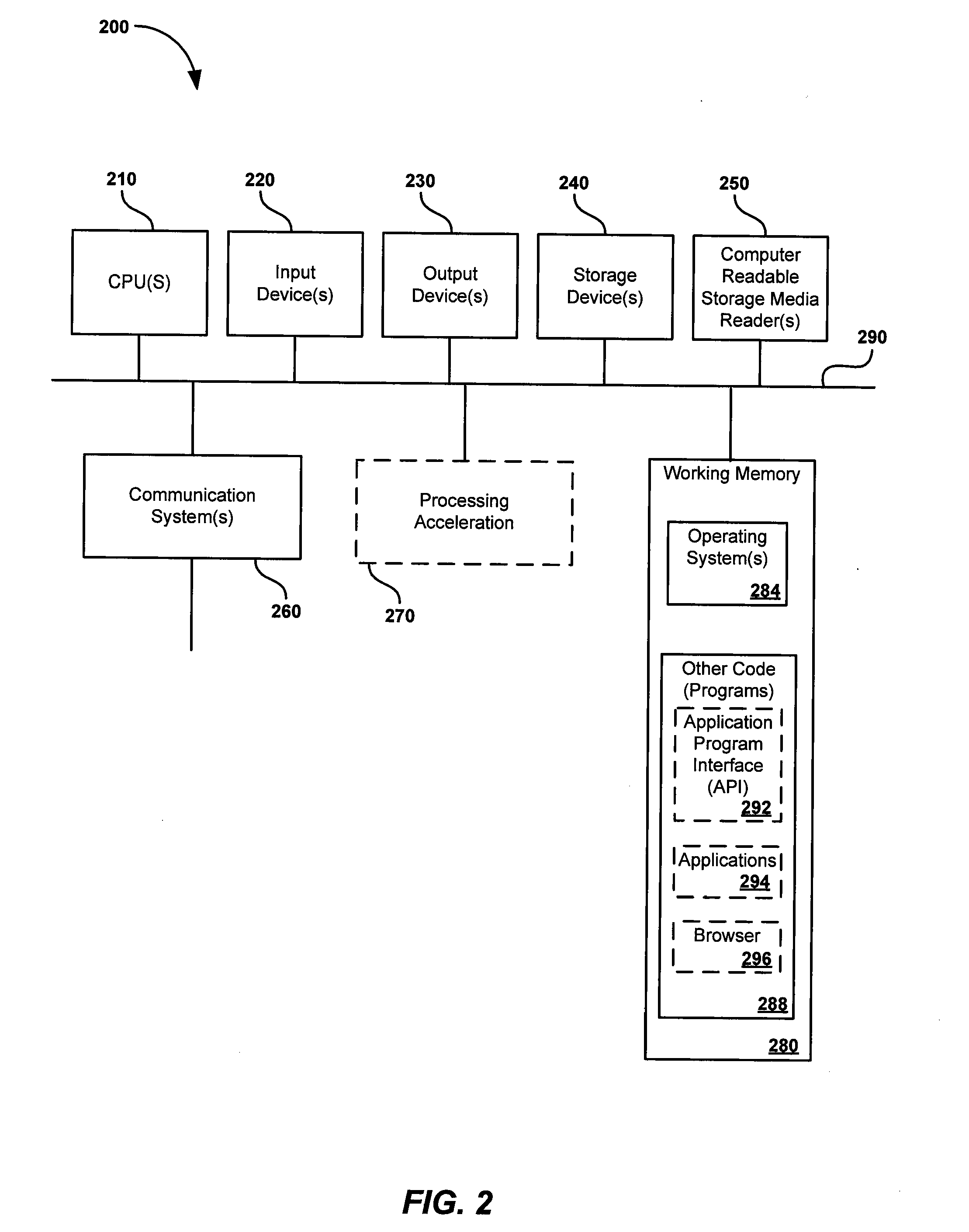

Risk analysis of money transfer transactions

A money transfer system includes a risk assessment system and a risk modeling system. The risk assessment system uses rules engines and Z scores to assess, on a real time basis, risk factors associated with money transfers. The risk modeling system develops risk scores based on historical transaction data in order to create a risk model. The risk model may be analyzed over time to refine the rules engines and take other actions to understand and reduce the risk of improper activity in connection with money transfers.

Owner:THE WESTERN UNION CO

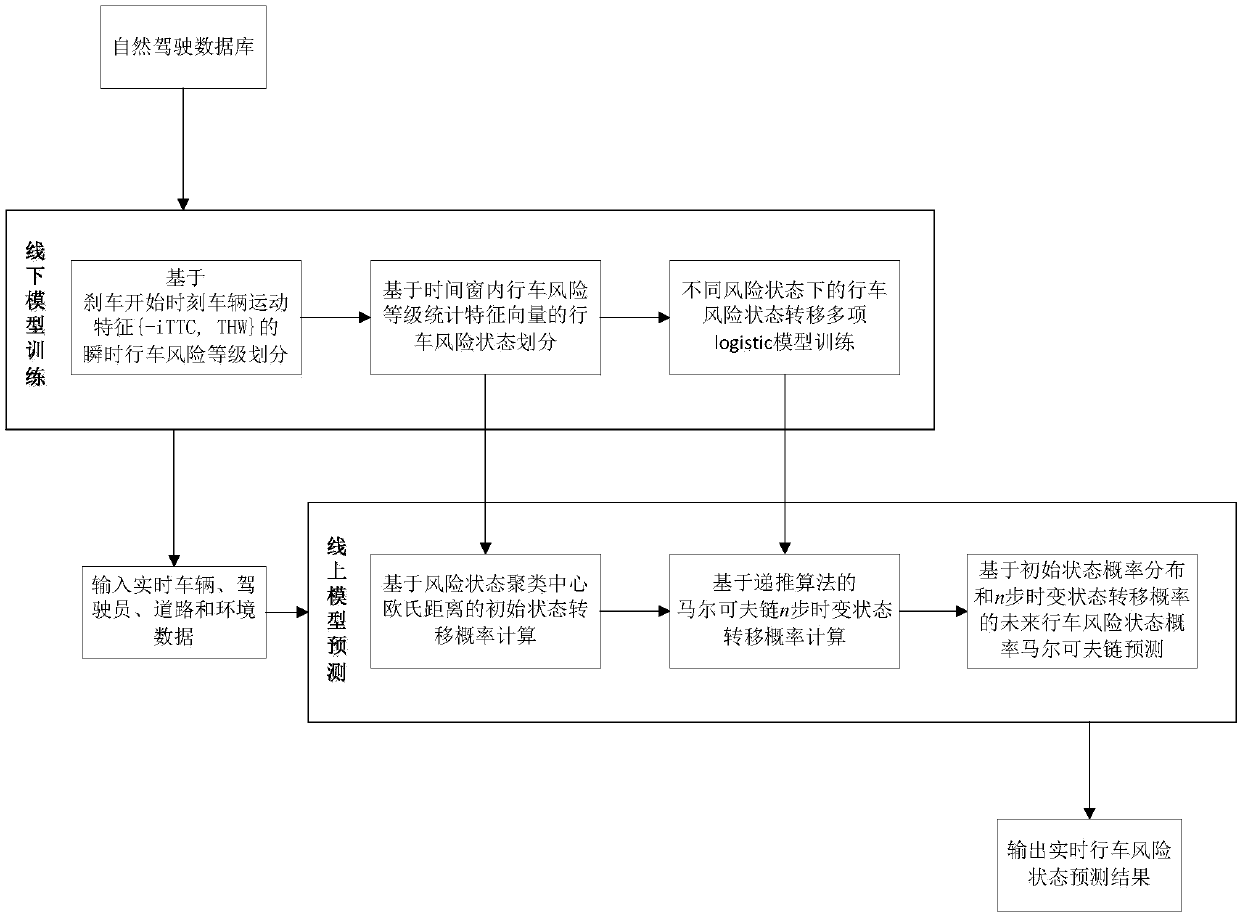

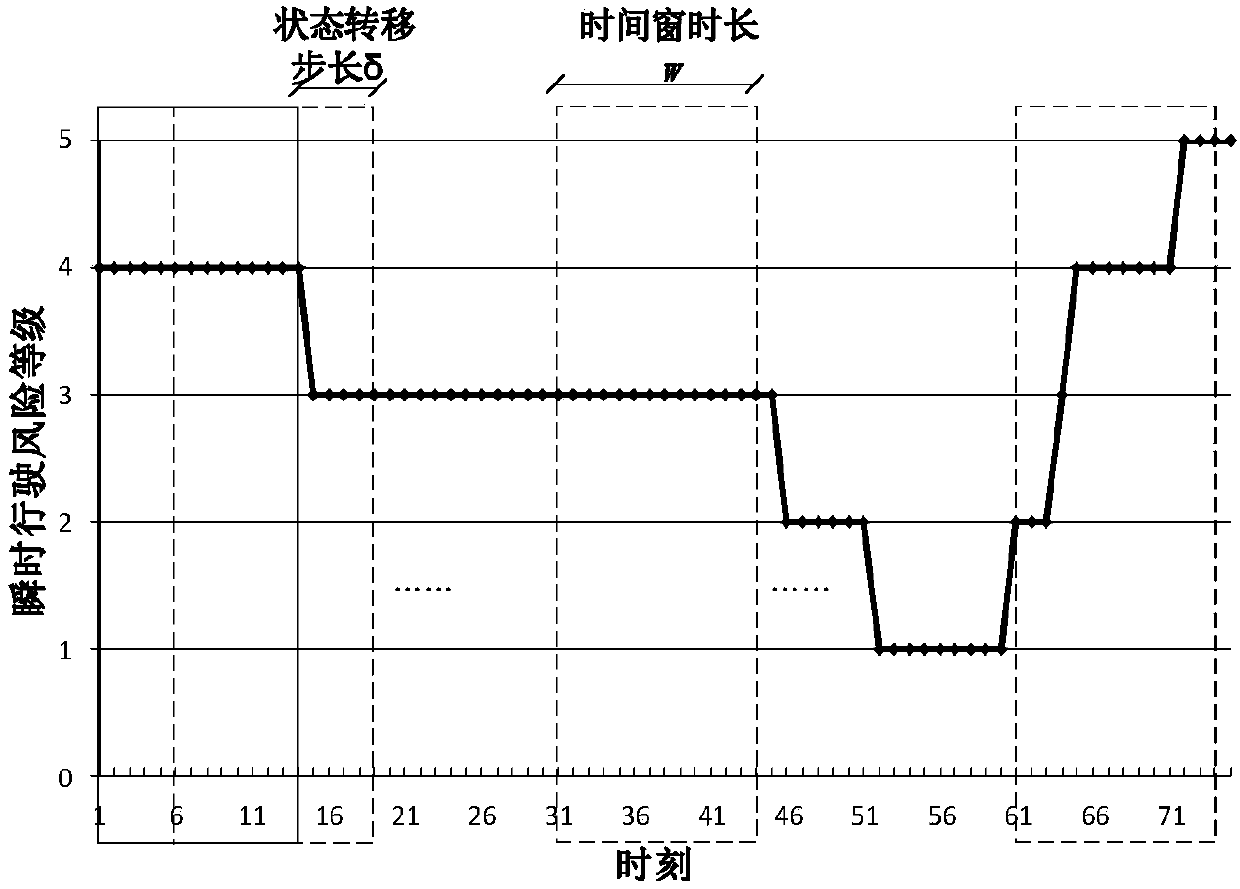

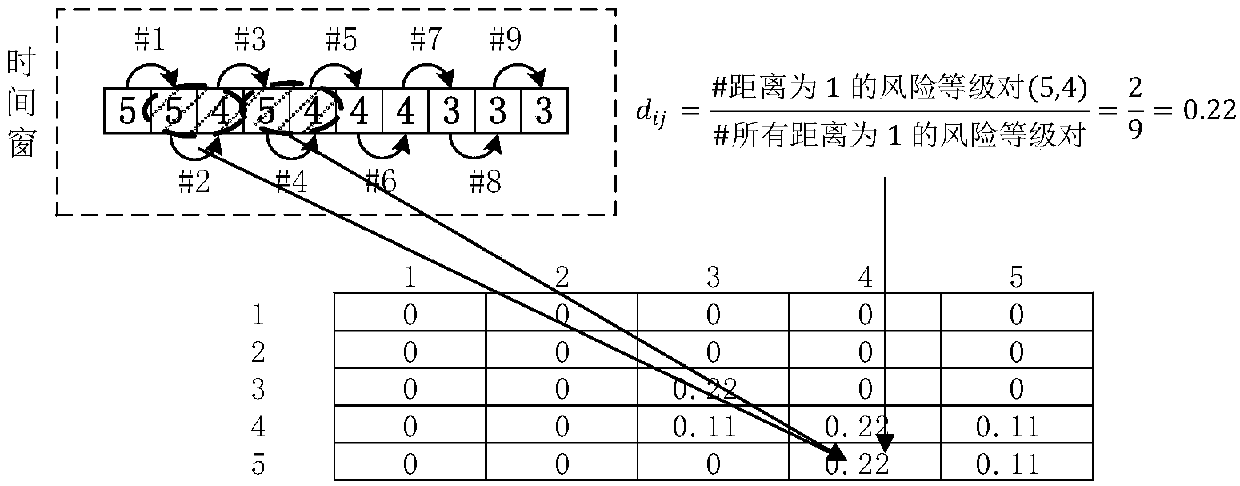

Vehicle driving risk prediction method based on time varying state transition probability markov chain

ActiveCN107742193AMeet the real-time requirements of anti-collision warningImprove accuracyResourcesDriving riskRisk model

The invention provides a vehicle driving risk prediction method based on time varying state transition probability markov chain. Firstly, an offline vehicle driving risk prediction model training: based on samples of accidents and near accidents, real-time vehicle driving risk states are divided by clustering time window characteristics parameters and regarded as countable states of the markov chain, and a multiterm logistic model of vehicle driving risk states transition in different vehicle driving risk states is built. Secondly, an online vehicle driving risk model real-time prediction: under the circumstance of car networking, the variable parameters required by a prediction model are collected in real time, through a risk state clustering center position and markov property, an original state probability distribution vector and a markov chain n steps transition probability at any time in the future are calculated, and the prediction result of the vehicle risk states in the futureis obtained. According to the invention, by means of a recurrence algorithm, the estimation of markov chain n steps time varying state transition probability is achieved, which can reflect the characteristics of the vehicle driving risk states changing with the characteristics of the transportation system, and can meet the requirement of early warning in real time.

Owner:JIANGSU UNIV

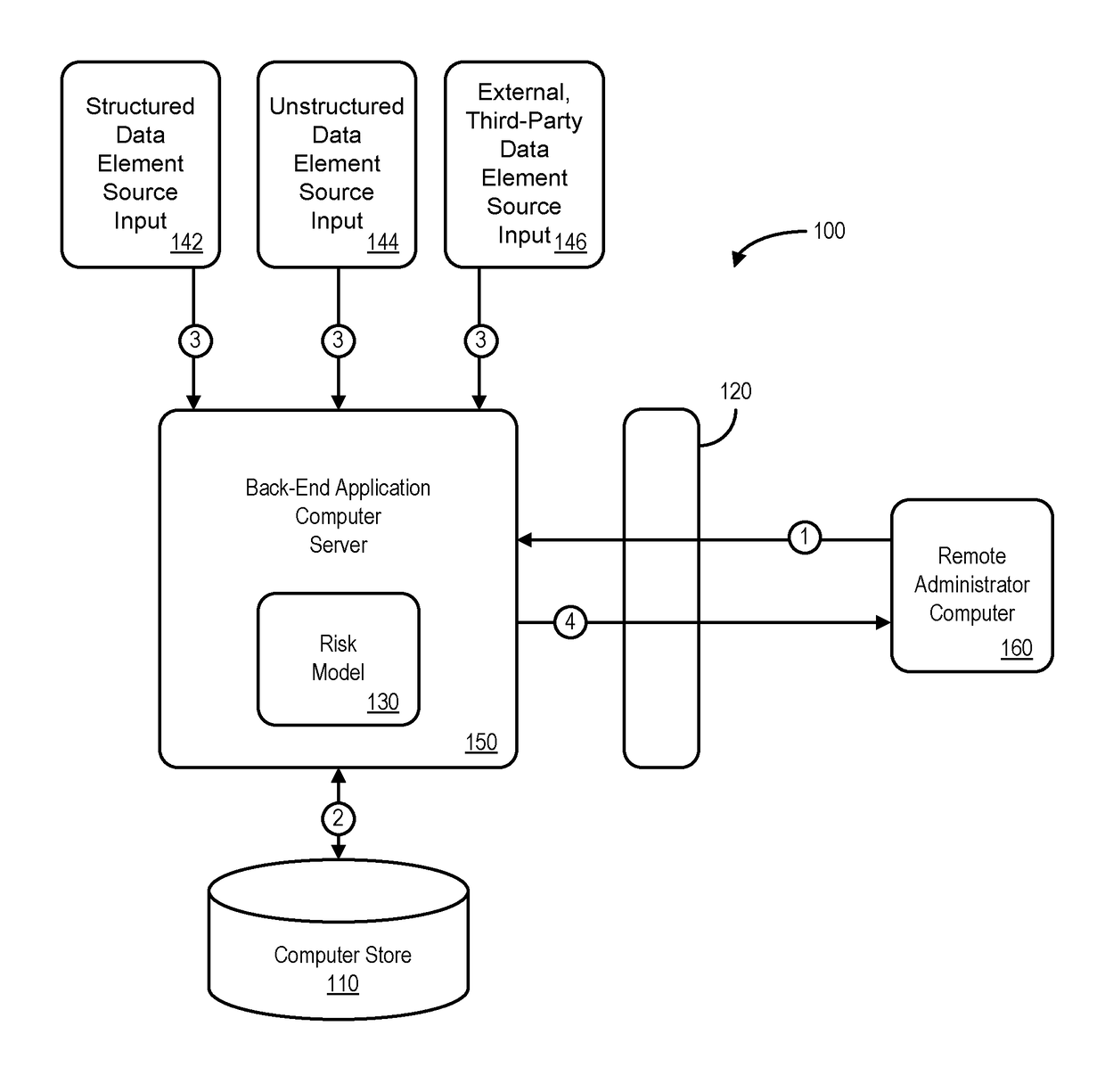

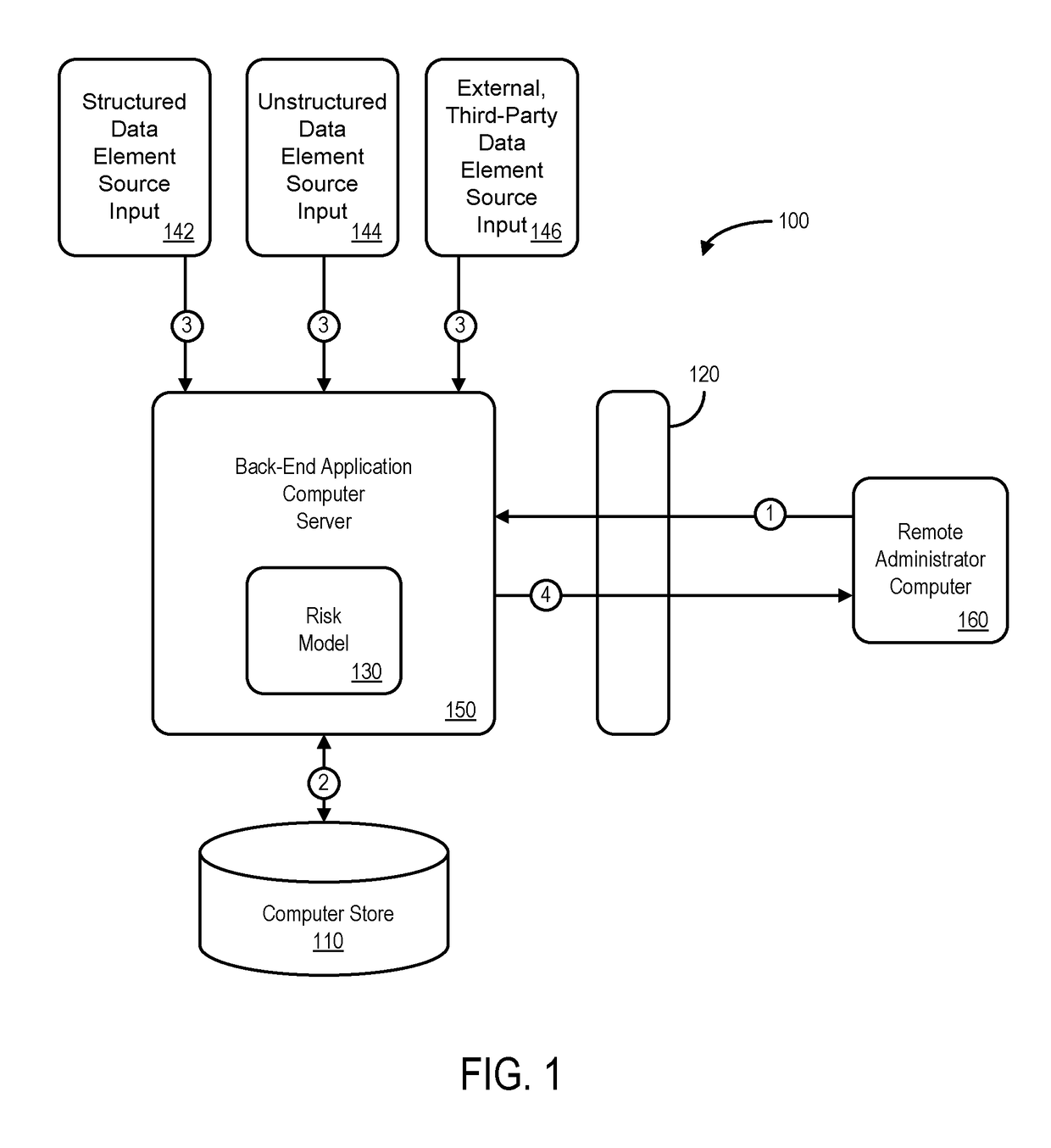

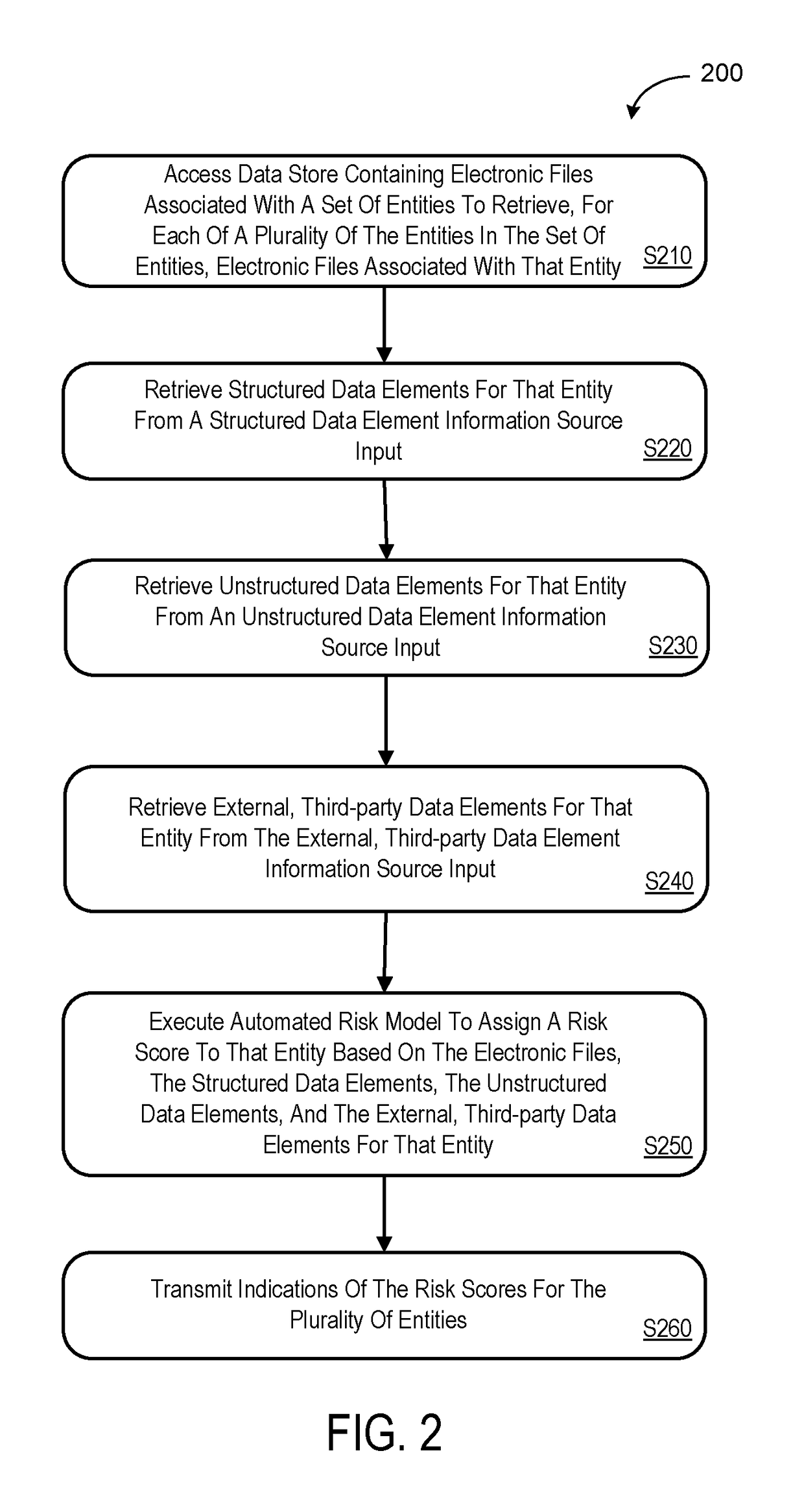

Processing system for data elements received via source inputs

ActiveUS20170154382A1Faster and accurate resultFast and accurate resultFinanceThird partyApplication computers

Mediums, apparatus, computer program code, and means may be provided to evaluate relative risks based at least in part on source inputs received via a distributed communication network by an automated back-end application computer server. According to some embodiments, the server may access a data store containing electronic files associated with a set of entities to retrieve, for each of a plurality of the entities in the set of entities, electronic files associated with that entity. The server may also retrieve structured data elements, unstructured data elements, and external, third-party data elements for that entity. The server may then execute an automated risk model to assign a risk score to that entity based on the electronic files, the structured data elements, the unstructured data elements, and the external, third-party data elements for that entity and transmit indications of the risk scores for the plurality of entities.

Owner:HARTFORD FIRE INSURANCE

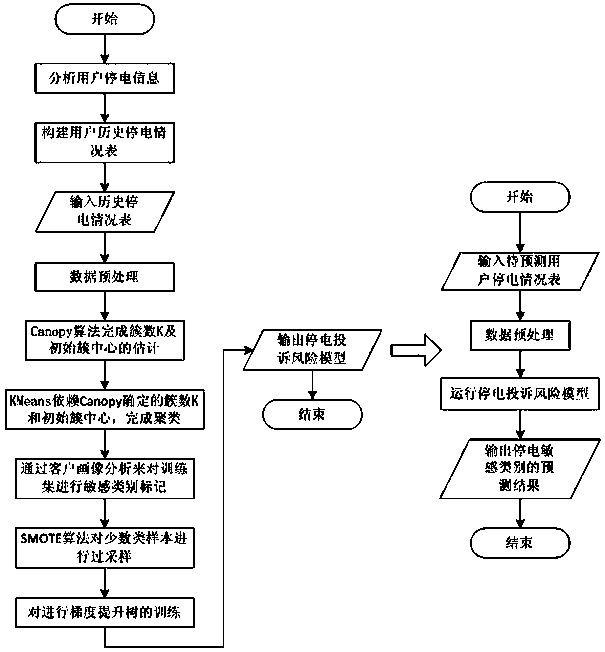

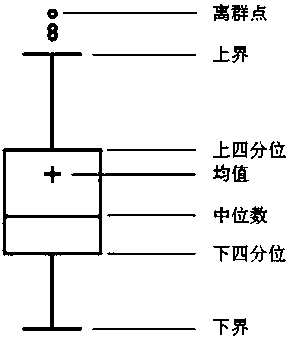

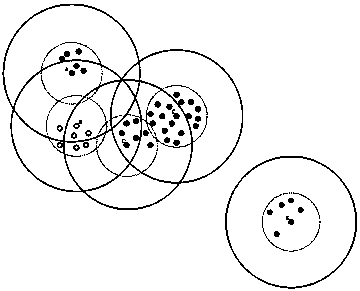

Gradient-boosted tree based power outage complaint risk prediction method

InactiveCN107220732AReduce the number of outage complaintsImprove service qualityForecastingCharacter and pattern recognitionElectricityData set

The invention relates to a gradient-boosted tree based power outage complaint risk prediction method, which comprises the steps of A, building a user power utilization information table; B, performing preprocessing on user power utilization information data sets in the user power utilization information table; C, performing clustering on the user power utilization information data sets by adopting a Canopy algorithm and a KMeans algorithm, carrying out sensitivity category marking on the user power utilization information data sets through client portrait analysis, then performing data processing on unbalance distribution user power utilization information data sets through a SPARK based SMOTE oversampling algorithm; D, performing gradient-boosted tree training on the user power utilization information data sets, and acquiring a power outage complaint risk model; and E, predicting the power outage sensitivity category of a user by using the power outage complaint risk model. The method facilitates to accurately judge the sensitivity degree of different users for power outage so as to adopt different pacifying and guiding strategies and reduce the number of power outage complaints of the users.

Owner:FUZHOU UNIV

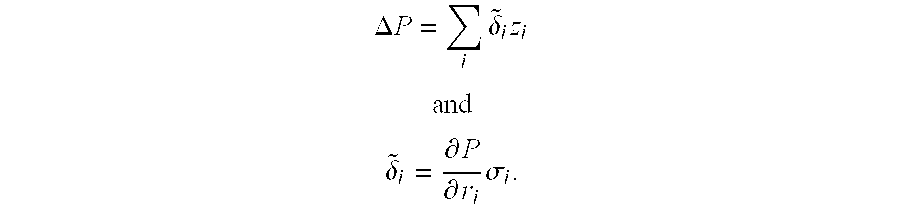

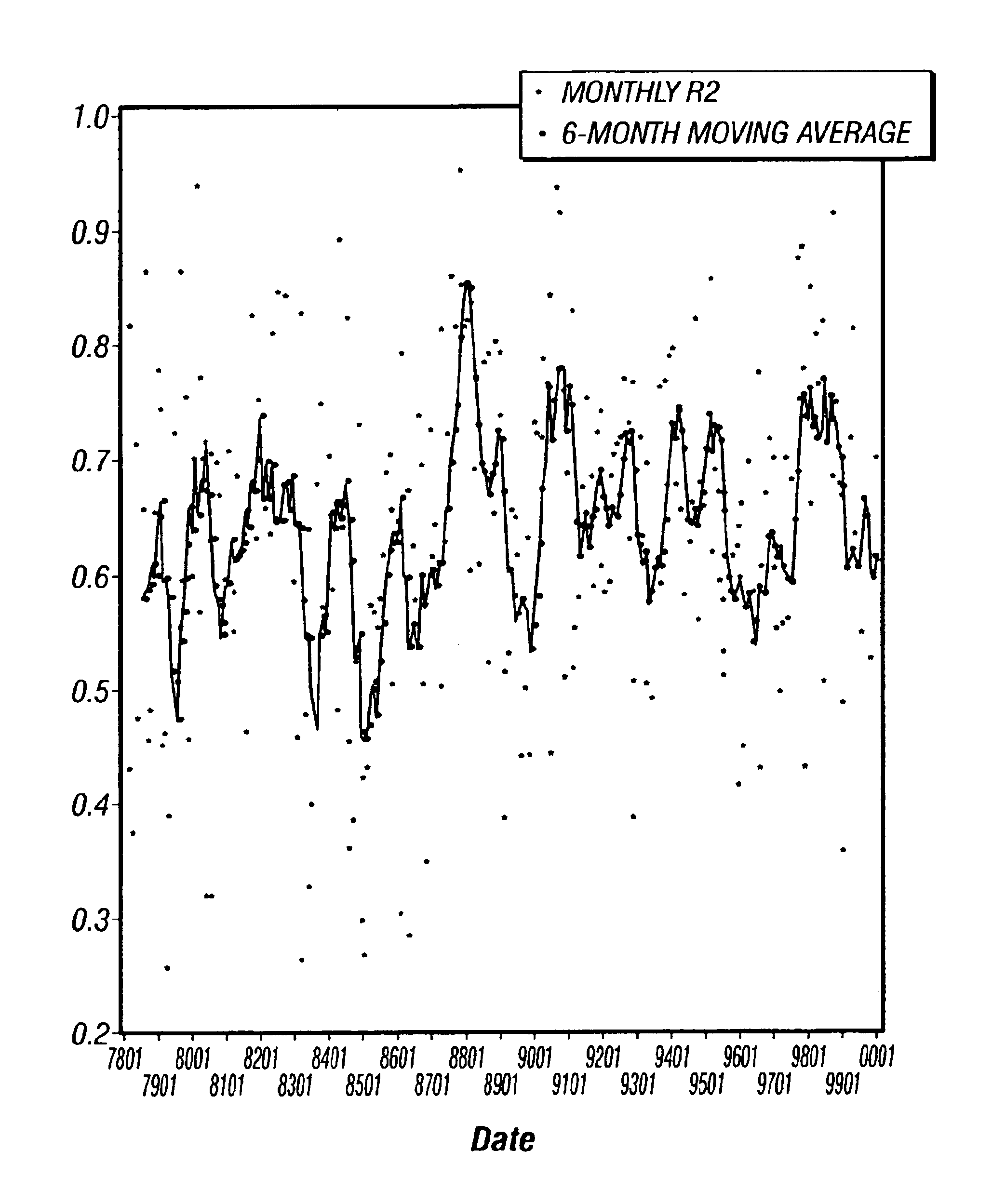

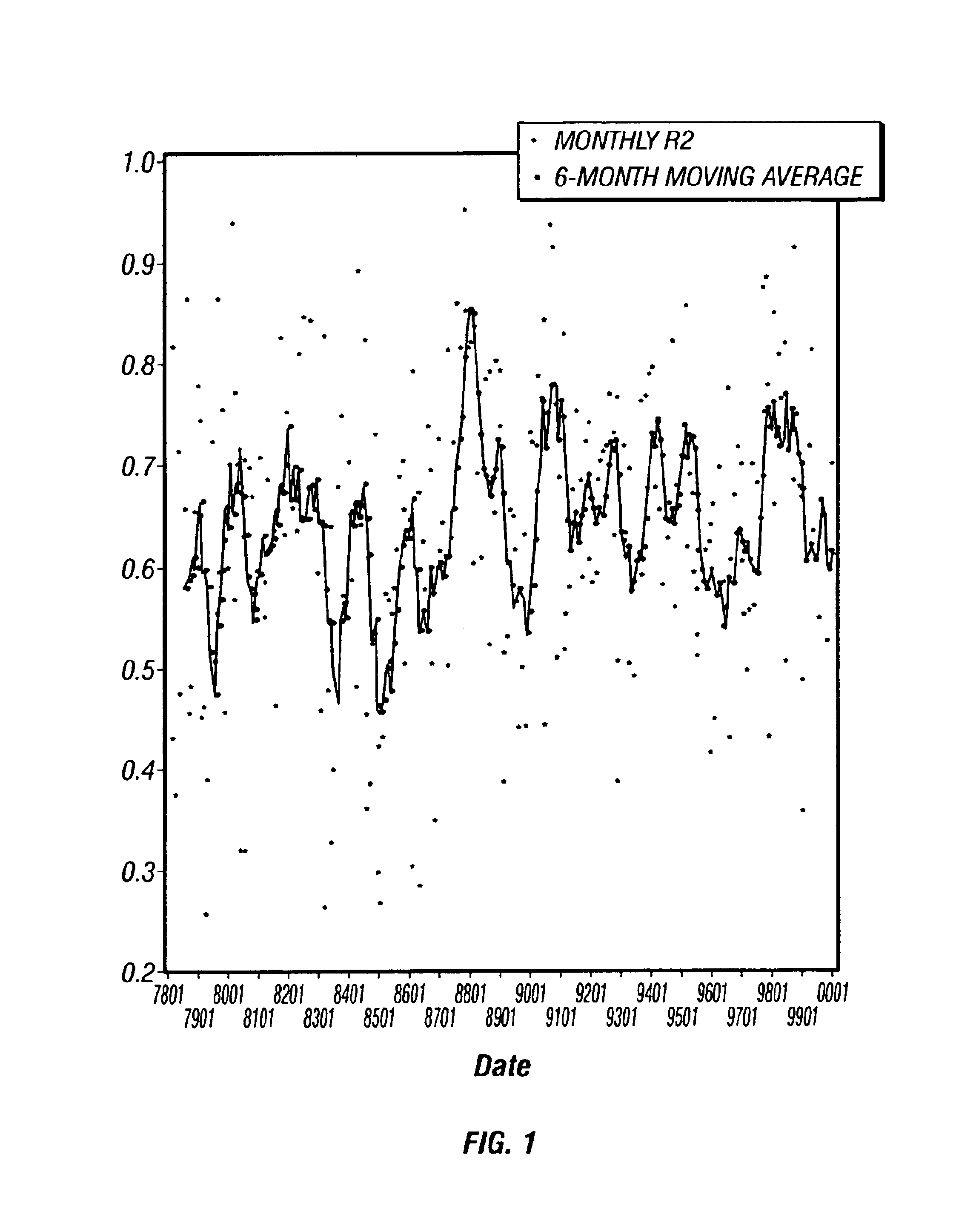

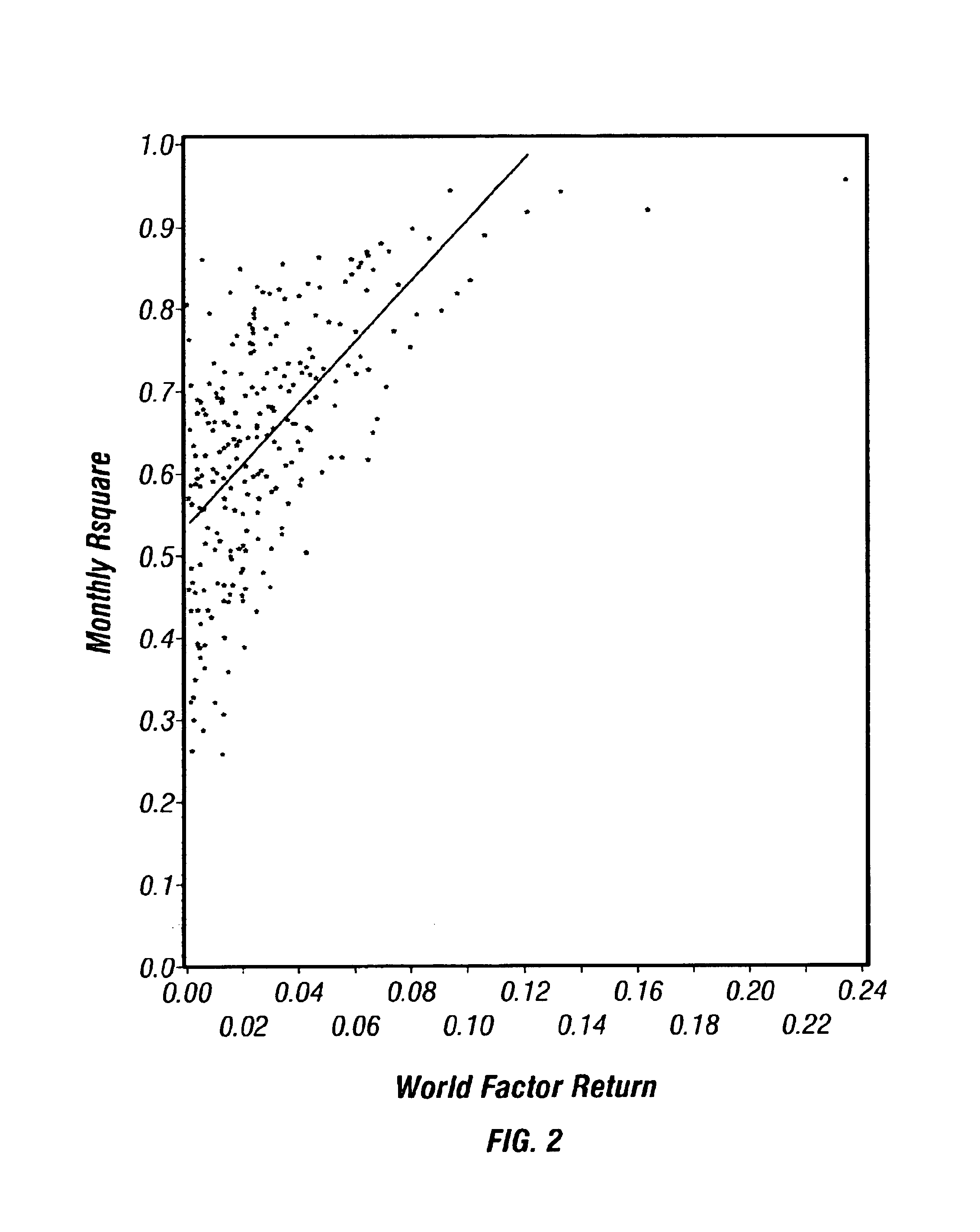

Method and apparatus for an integrative model of multiple asset classes

The invention provides a method and apparatus for combining two or more risk models to create a risk model with wider scope than its constituent parts. The method insures that the newly formed risk model is consistent with the component models from which it is formed.

Owner:BARRA

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com