Patents

Literature

36 results about "Future risk" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

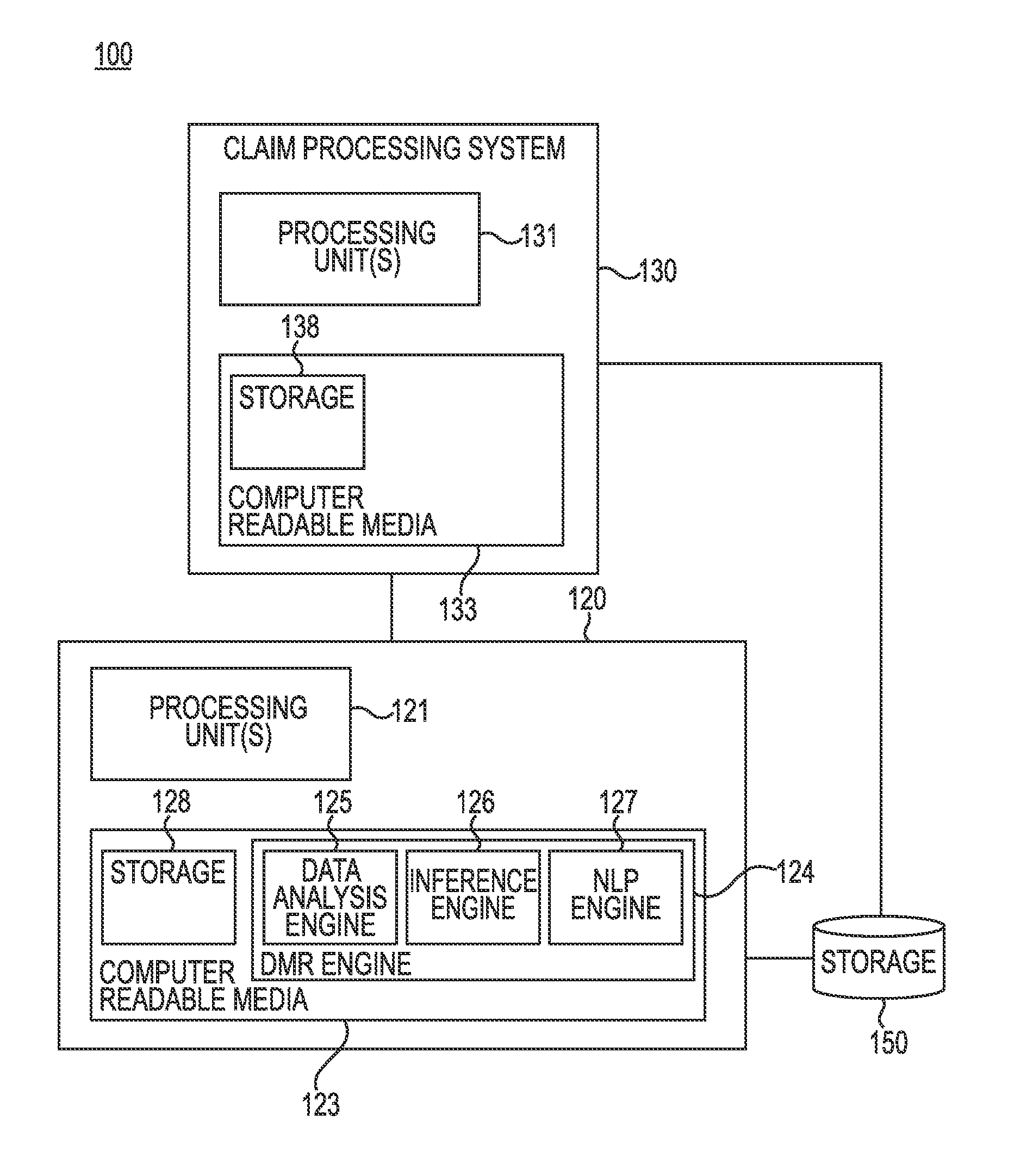

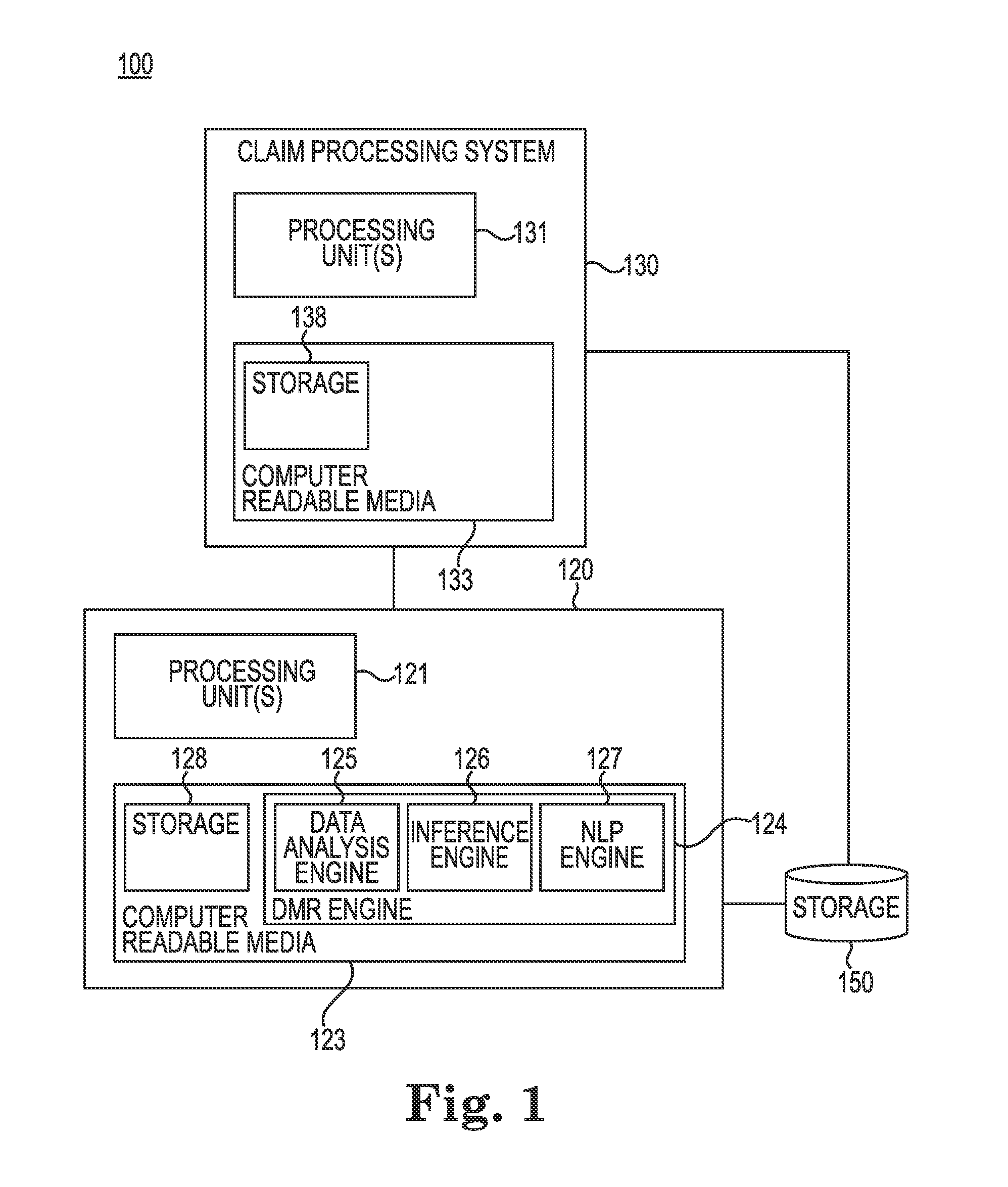

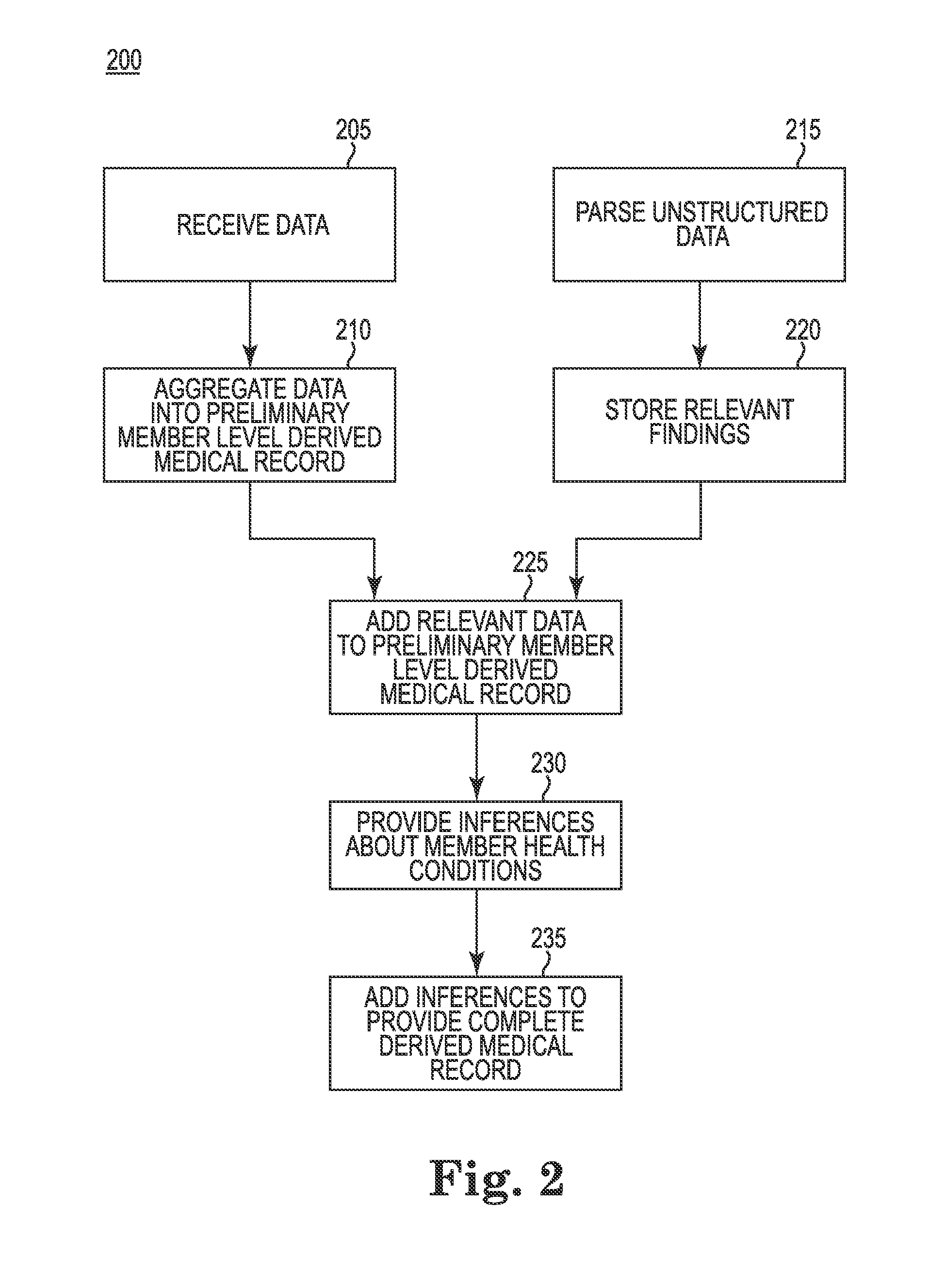

Computer readable storage media for utilizing derived medical records and methods and systems for same

InactiveUS20150332003A1Office automationSpecial data processing applicationsMedical recordUnstructured data

Disclosed embodiments include methods and systems for creating and utilizing derived medical records. In accordance with one or more embodiments, a derived medical record system may utilize one or more derived medical records to improve insight into patient health, identify future risk factors, and improve claim processing efficiency. In some examples, the derived medical record system may further provide derived medical records based on healthcare data stored in structured and unstructured data sources.

Owner:UNITEDHEALTH GROUP

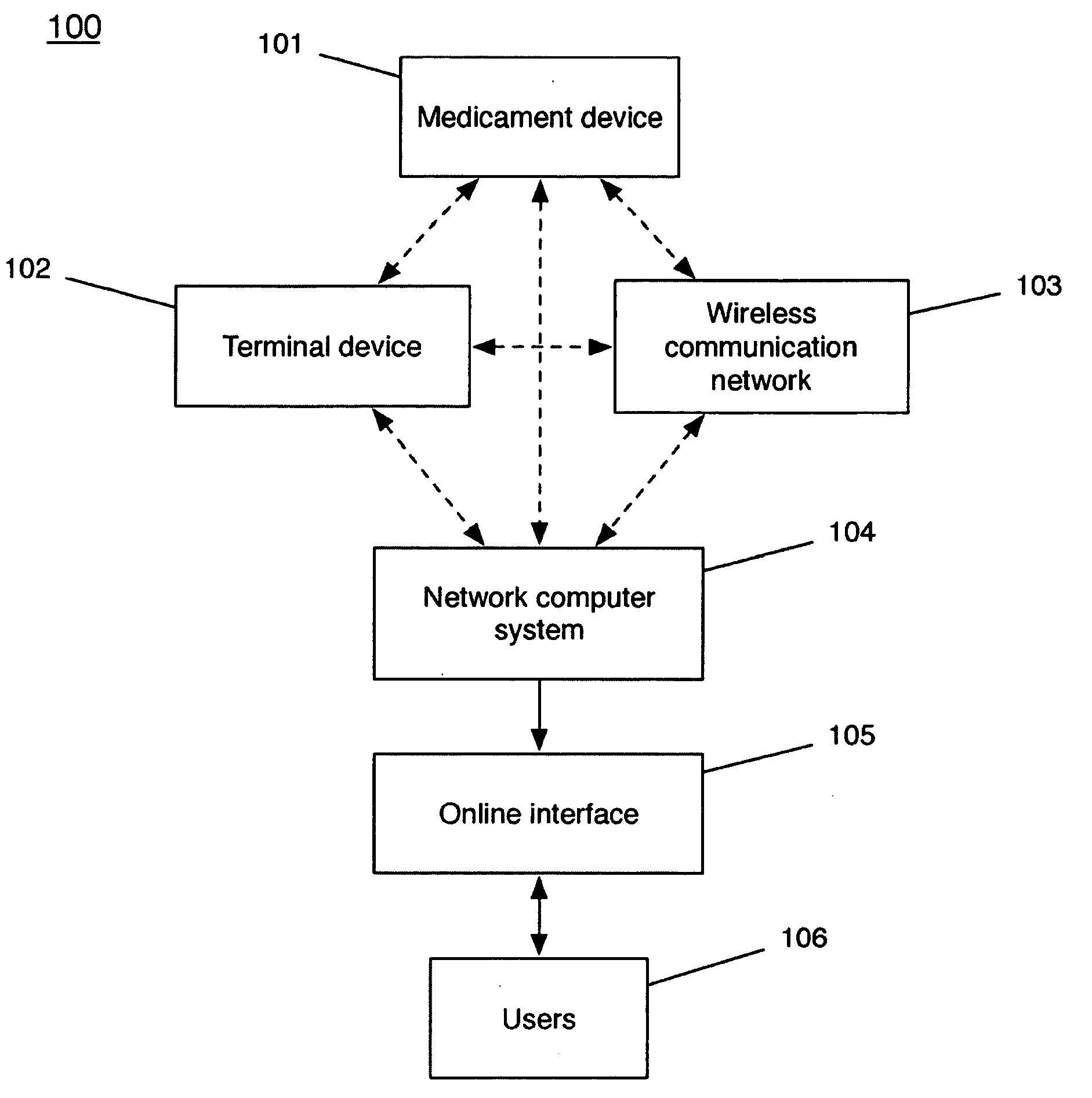

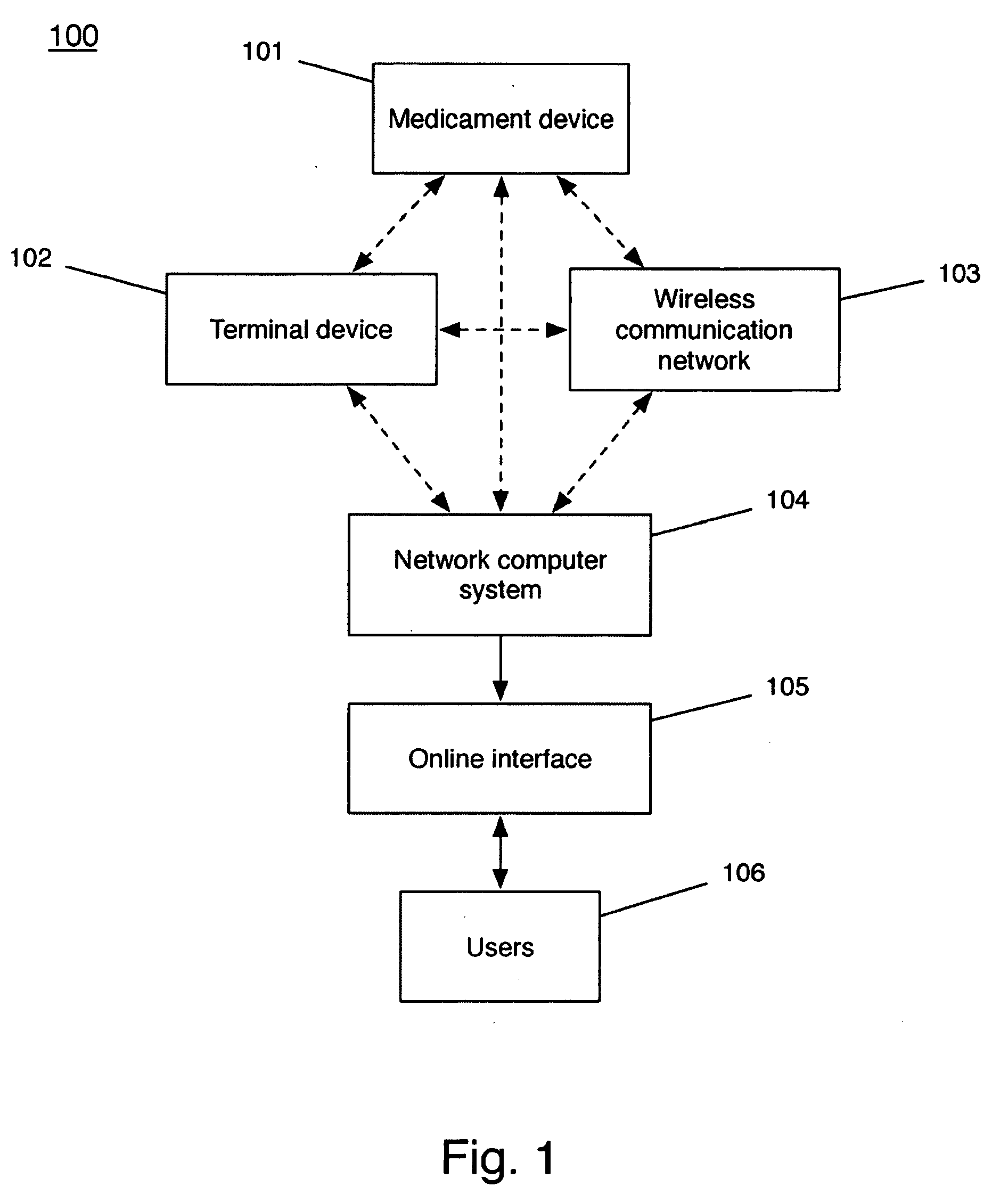

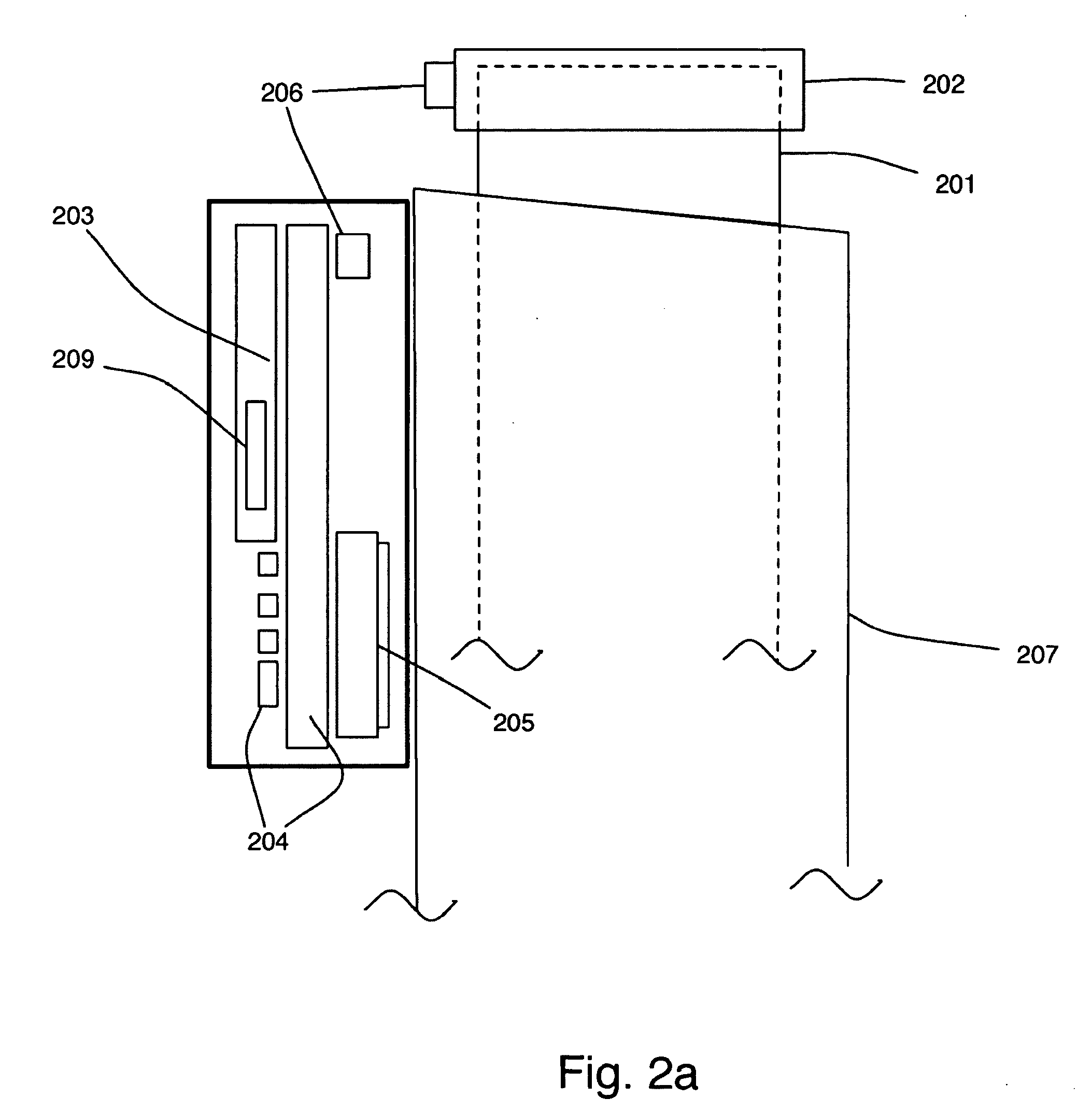

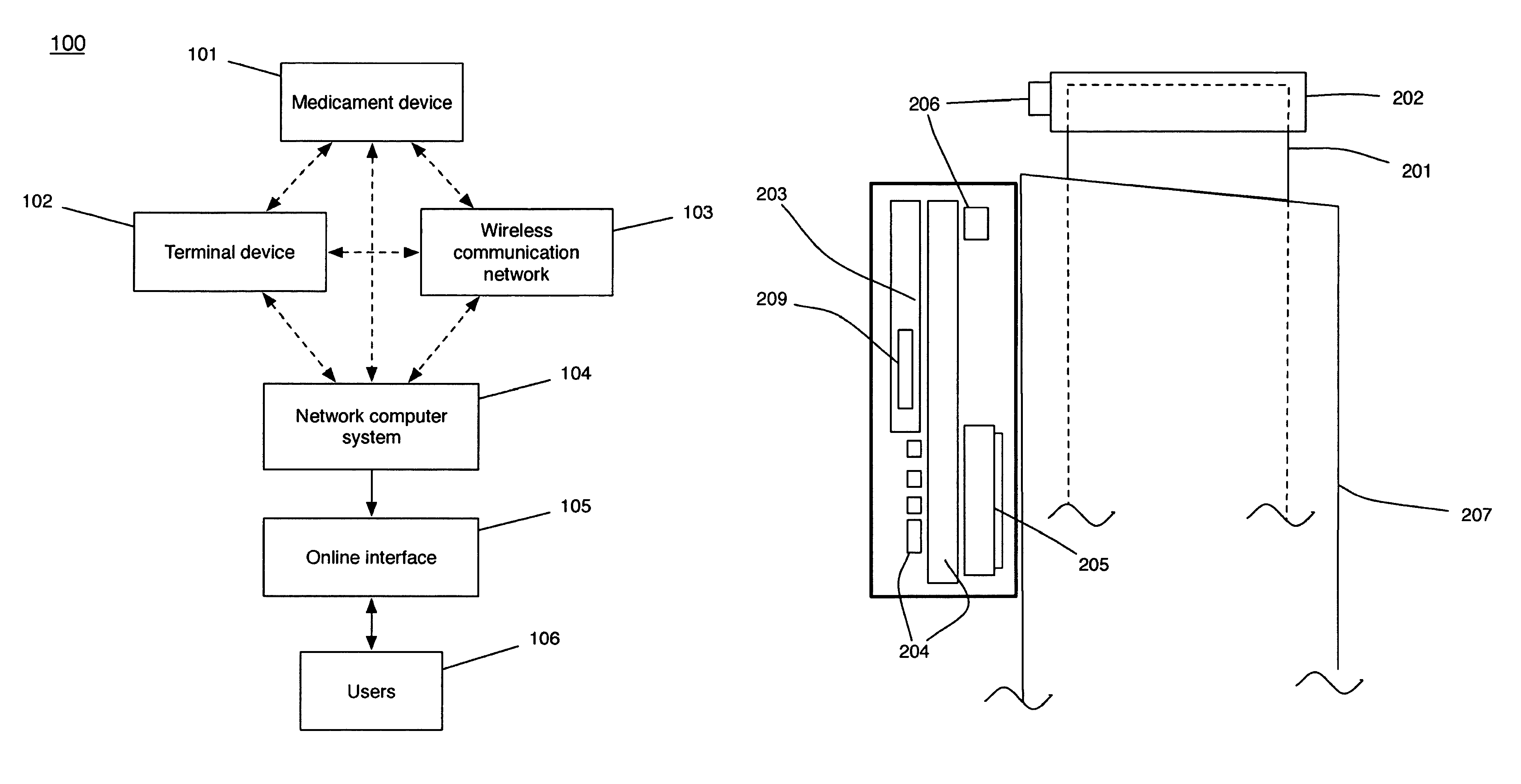

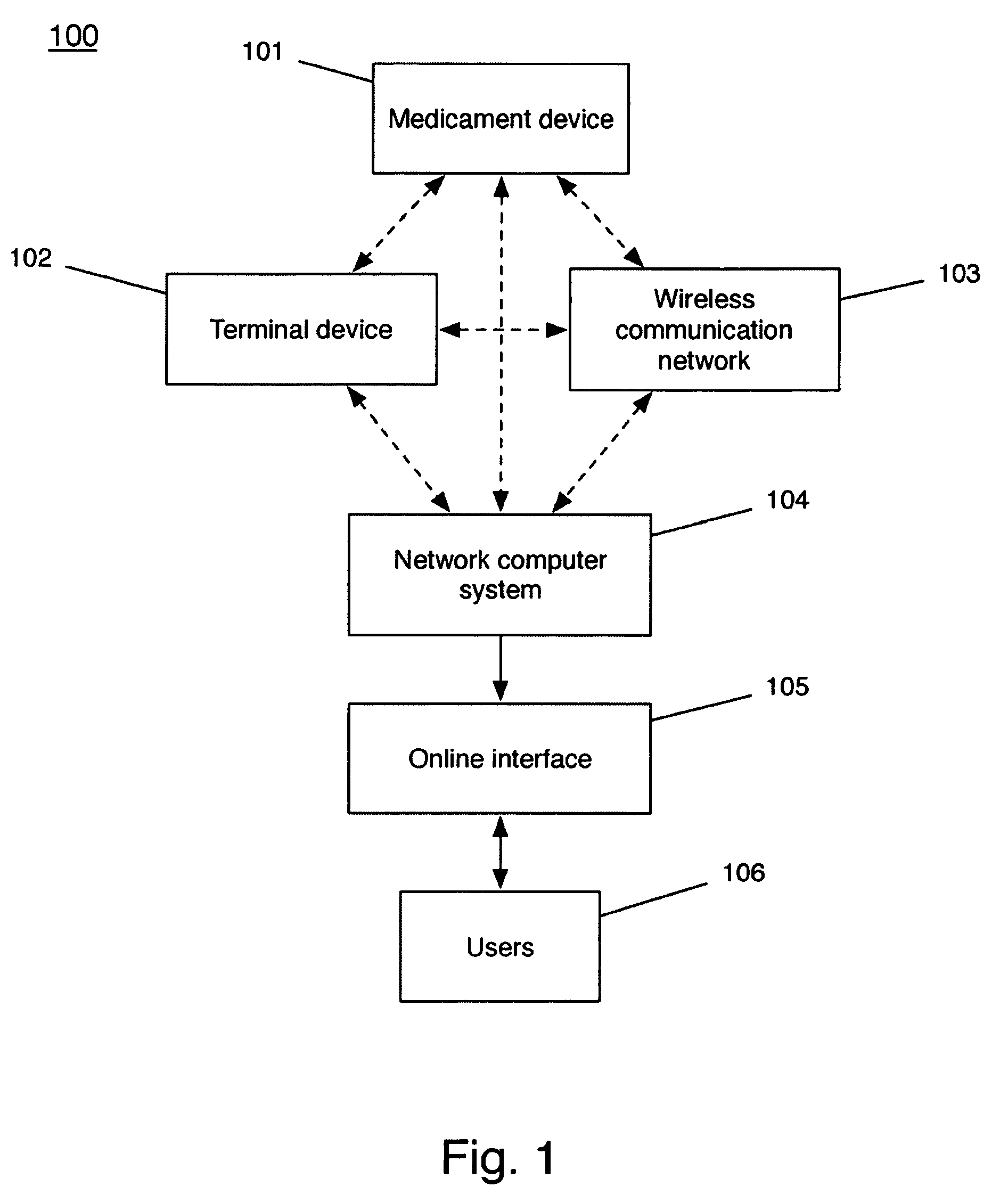

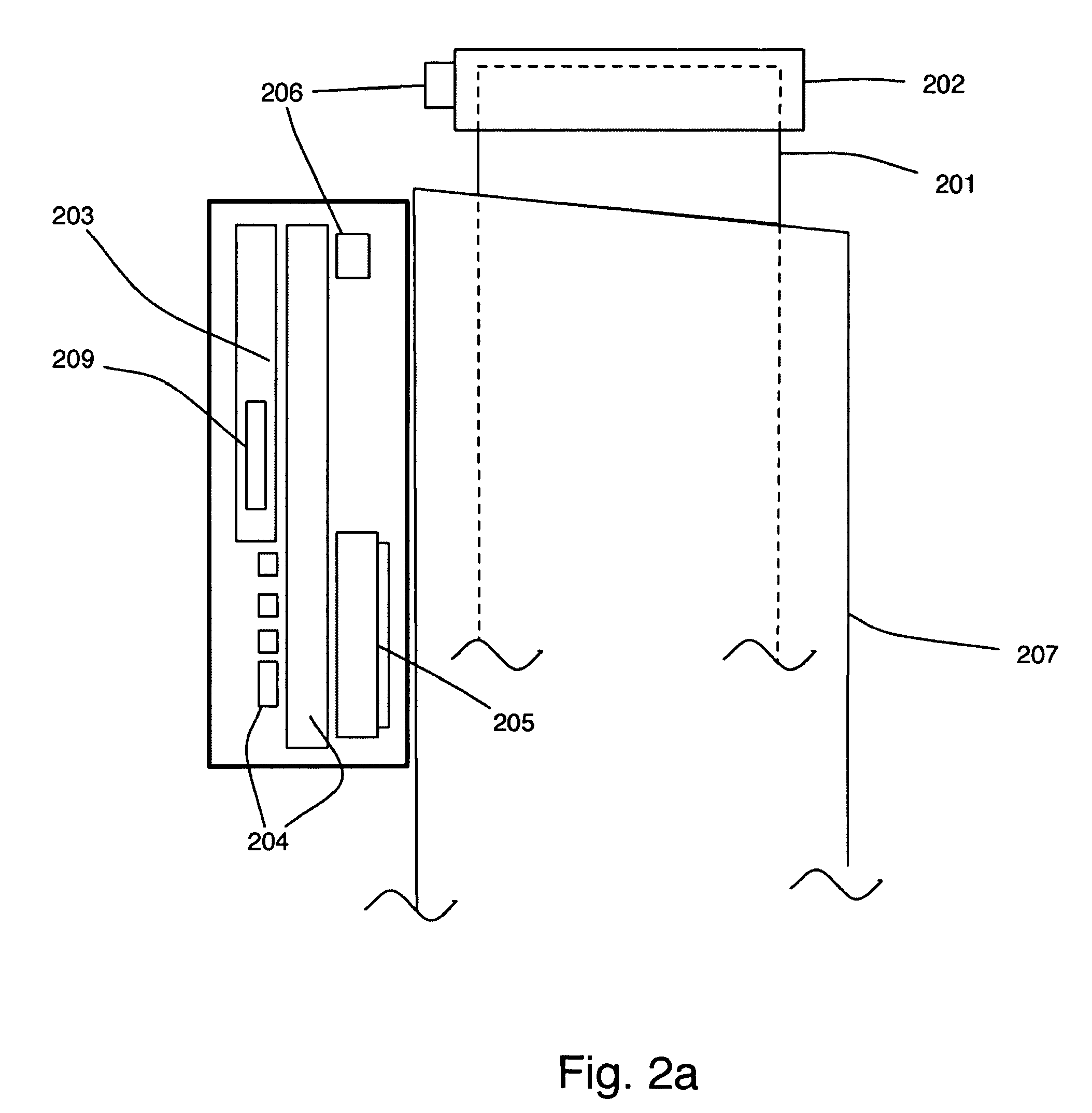

Device and method to monitor, track, map, and analyze usage of metered-dose inhalers in real-time

ActiveUS20090194104A1Easy to manageEasy to identifyRespiratorsDrug and medicationsClinical careComputer science

A system and method for accurately and reliably determining and recording the time, date and location where a medication is used, and a system and method for transmitting, collecting, and using that data to improve clinical care, disease management, and public health surveillance. The device allows information concerning drug usage, including the time, date and location of use, to be transmitted to a remote network computer system so that the data can be evaluated to determine current impairment and future risk, and to identify changes in the frequency, timing, or location of medication usage indicative of change in disease control or management, and to examine spatial, temporal or demographic patterns of medication use or absence of use among individuals and groups. In addition, the device may further be configured to transmit signals indicative of its status, condition or other results to the remote network computer system.

Owner:RECIPROCAL LABS CORP D B A PROPELLER HEALTH

Methods and devices for rotator cuff repair

ActiveUS8016883B2High strengthIncrease flexibilitySuture equipmentsLigamentsBiocompatibility TestingPediatric population

Interposition and augmentation devices for tendon and ligament repair, including rotator cuff repair, have been developed as well as methods for their delivery using arthroscopic methods. The devices are preferably derived from biocompatible polyhydroxyalkanoates, and preferably from copolymers or homopolymers of 4-hydroxybutyrate. The devices may be delivered arthroscopically, and offer additional benefits such as support for the surgical repair, high initial strength, prolonged strength retention in vivo, flexibility, anti-adhesion properties, improved biocompatibility, an ability to remodel in vivo to healthy tissue, minimal risk for disease transmission or to potentiate infection, options for fixation including sufficiently high strength to prevent suture pull out or other detachment of the implanted device, eventual absorption eliminating future risk of foreign body reactions or interference with subsequent procedures, competitive cost, and long-term mechanical stability. The devices are also particularly suitable for use in pediatric populations where their eventual absorption should not hinder growth.

Owner:TEPHA INC

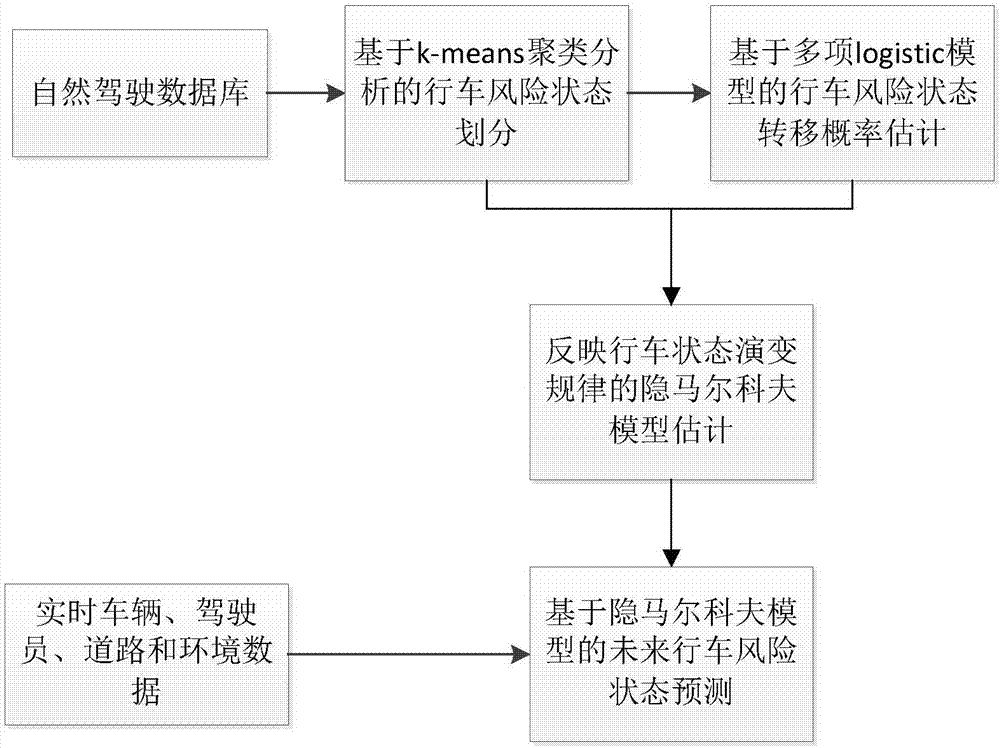

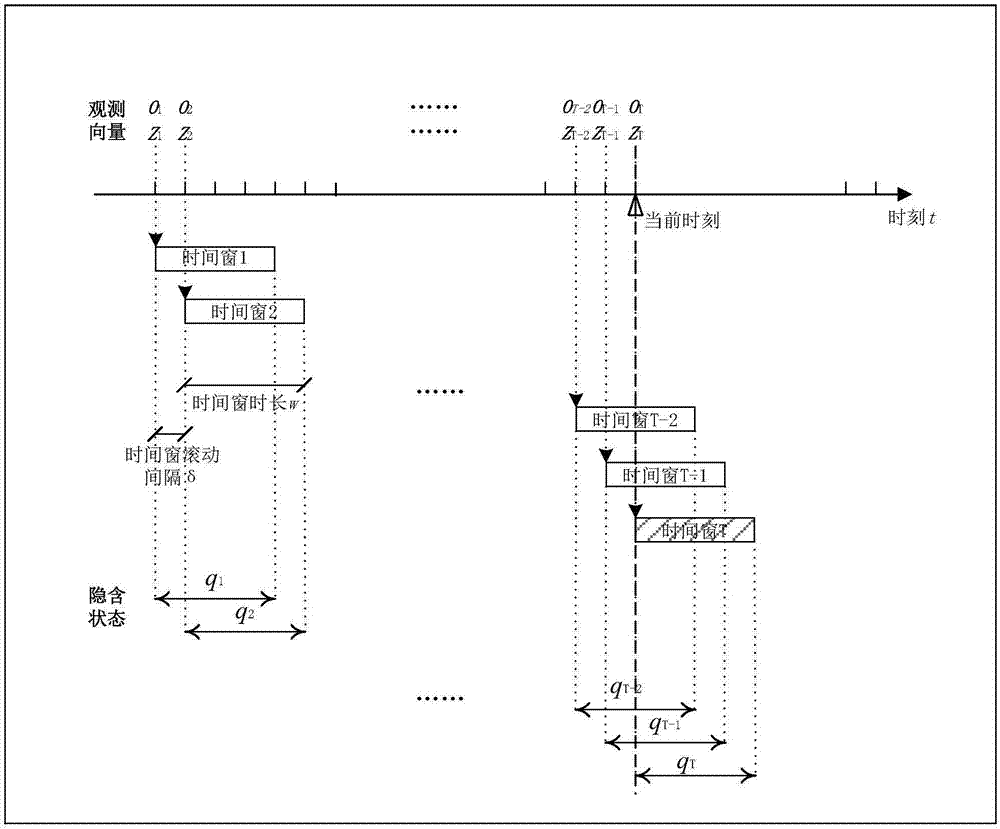

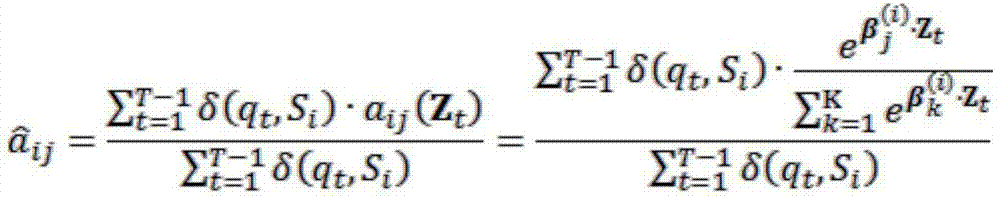

Prediction method of driving risk based on hidden Markov model

ActiveCN107958269AImprove accuracyImprove forecast accuracyData processing applicationsCharacter and pattern recognitionHidden markov chain modelRisk model

The invention discloses a prediction method of driving risk based on a hidden Markov model. The method comprises the steps of (1) classifying driving risk states through a cluster analysis method based on vehicle operating characteristics, (2) estimating the influences of a driver behavior and surrounding traffic environment characteristics on a transition probability between driving risk states through multiple logistical models for different driving risk states, (3) with a risk state as a hidden state, with an actual observed vehicle movement variable as a state output value, with multiple logistic model parameters as parameter initial values of a state transition probability matrix, establishing a hidden Markov chain model that reflects the evolution rule of driving states, and (4) obtaining the vehicle operating characteristics in real time and predicting a future risk state based on the hidden Markov chain model. According to the method, the hidden Markov model which can reflect the above characteristic real-time change and has a variable state transition probability is established, the accuracy and prediction accuracy of a driving risk model are improved, and the real-time requirements of anti-collision warning can be satisfied.

Owner:JIANGSU UNIV

Device and method to monitor, track, map, and analyze usage of metered-dose inhalers in real-time

ActiveUS9550031B2Easy to manageEasy to identifyRespiratorsDrug and medicationsClinical careComputer science

A system and method for accurately and reliably determining and recording the time, date and location where a medication is used, and a system and method for transmitting, collecting, and using that data to improve clinical care, disease management, and public health surveillance. The device allows information concerning drug usage, including the time, date and location of use, to be transmitted to a remote network computer system so that the data can be evaluated to determine current impairment and future risk, and to identify changes in the frequency, timing, or location of medication usage indicative of change in disease control or management, and to examine spatial, temporal or demographic patterns of medication use or absence of use among individuals and groups. In addition, the device may further be configured to transmit signals indicative of its status, condition or other results to the remote network computer system.

Owner:RECIPROCAL LABS CORP D B A PROPELLER HEALTH

Methods and Devices for Rotator Cuff Repair

ActiveUS20070198087A1High strengthProlonged in flexibility propertySuture equipmentsLigamentsDiseaseBiocompatibility Testing

Interposition and augmentation devices for tendon and ligament repair, including rotator cuff repair, have been developed as well as methods for their delivery using arthroscopic methods. The devices are preferably derived from biocompatible polyhydroxyalkanoates, and preferably from copolymers or homopolymers of 4-hydroxybutyrate. The devices may be delivered arthroscipiclly, and offer additional benefits such as support for the surgical repair, high initial strength, prolonged strength retention in vivo, flexibility, anti-adhesion properties, improved biocompatibility, an ability to remodel in vivo to healthy tissue, minimal risk for disease transmission or to potentiate infection, options for fixation including sufficiently high strength to prevent suture pull out or other detachment of the implanted device, eventual absorption eliminating future risk of foreign body reactions or interference with subsequent procedures, competitive cost, and long-term mechanical stability. The device are also particularly suitable for use in pediatric populations where their eventual absorption should not hinder growth.

Owner:TEPHA INC

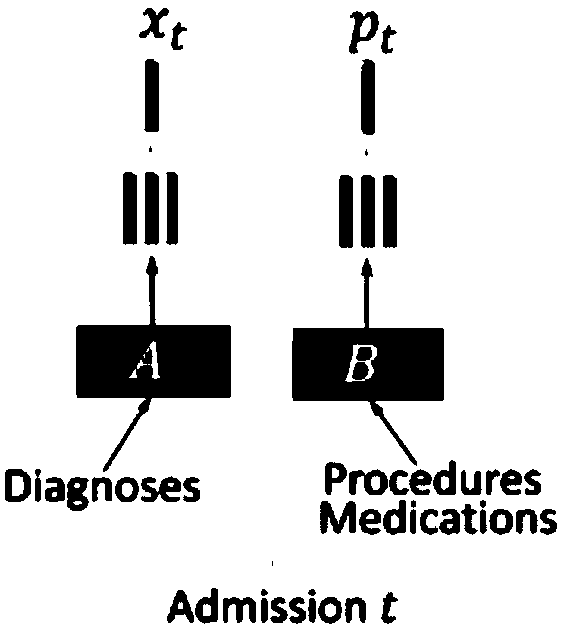

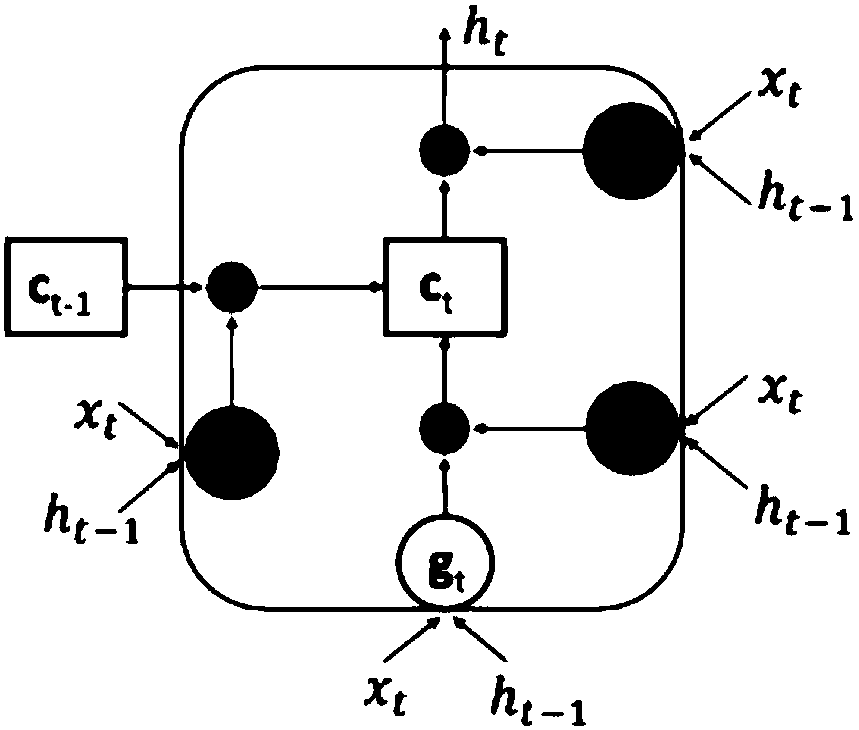

Method for deeply learning and predicting medical track based on medical records

ActiveCN109599177AProven validityImprove accuracyHealth-index calculationMedical automated diagnosisMedical recordTime structure

The invention discloses a method for deeply learning and predicting medical track based on medical records. The method comprises the following steps: S1, encoding diagnostic information and intervention information on admission through an encoding scheme and converting code into vector to acquire diagnostic information conversion vector (the formula is shown in the description) and intervention information conversion vector (the formula is shown in the description) separately, and converting the diagnostic information and intervention information on admission for one time into one 2M-dimensional vector [xt, pt]; S2, input the vector [xt, pt] into an LSTM model, and evaluating the current output value ht to obtain the current disease state; S3, predicting a diagnostic code dt+1 according tothe disease state ht and predicting the disease progression through the diagnostic code dt+1; S4, calculating an intervention code st of the time t, increasing a time structure in the LSTM model, collecting the historical disease states in multiple time ranges, collecting the state of each section of a horizontal time shaft, collecting all the diseases states, stacking into a vector (the formulais shown in the description), and feeding back the vector (the formula is shown in the description) into a nerve network to predict the future risk result Y.

Owner:莫毓昌

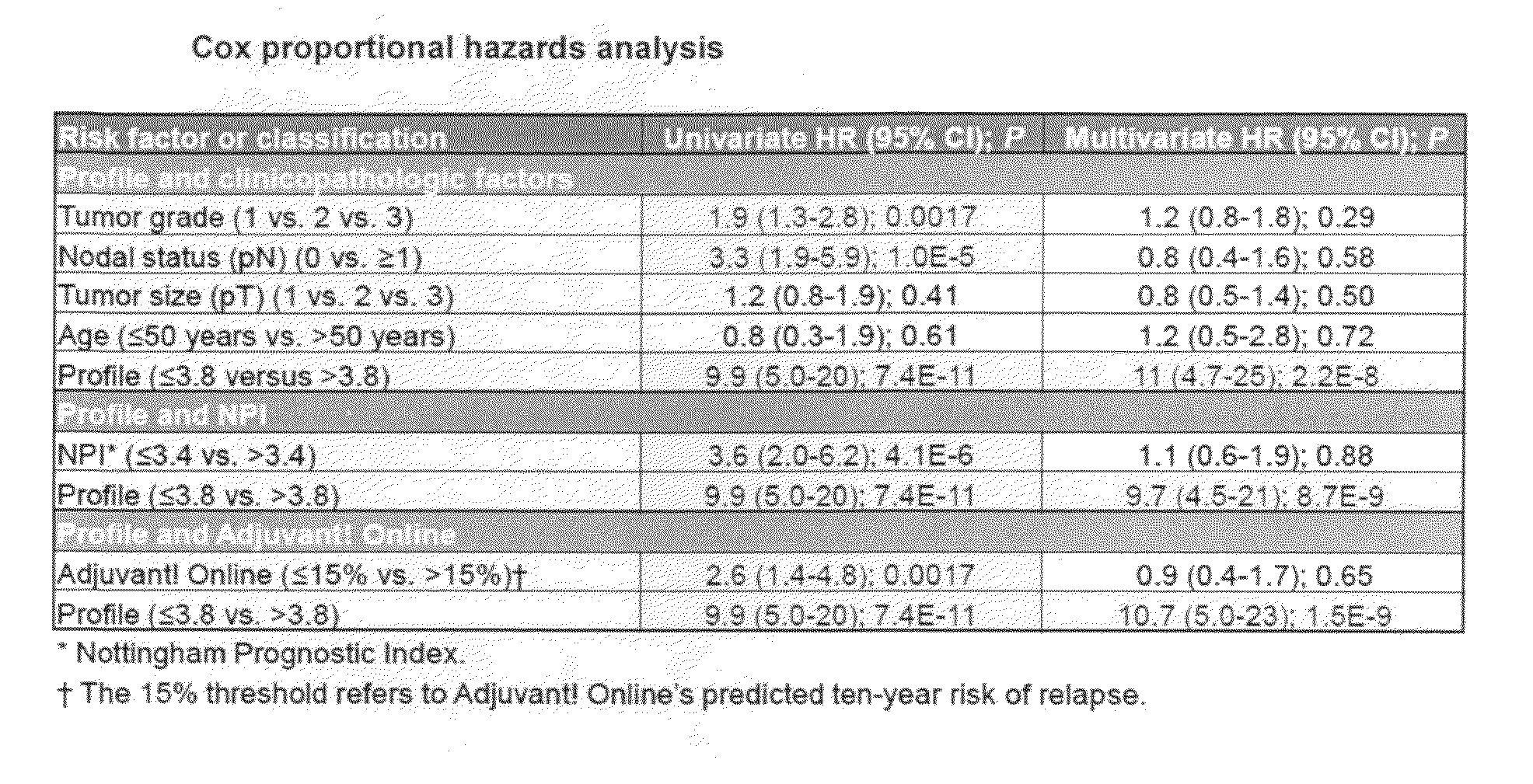

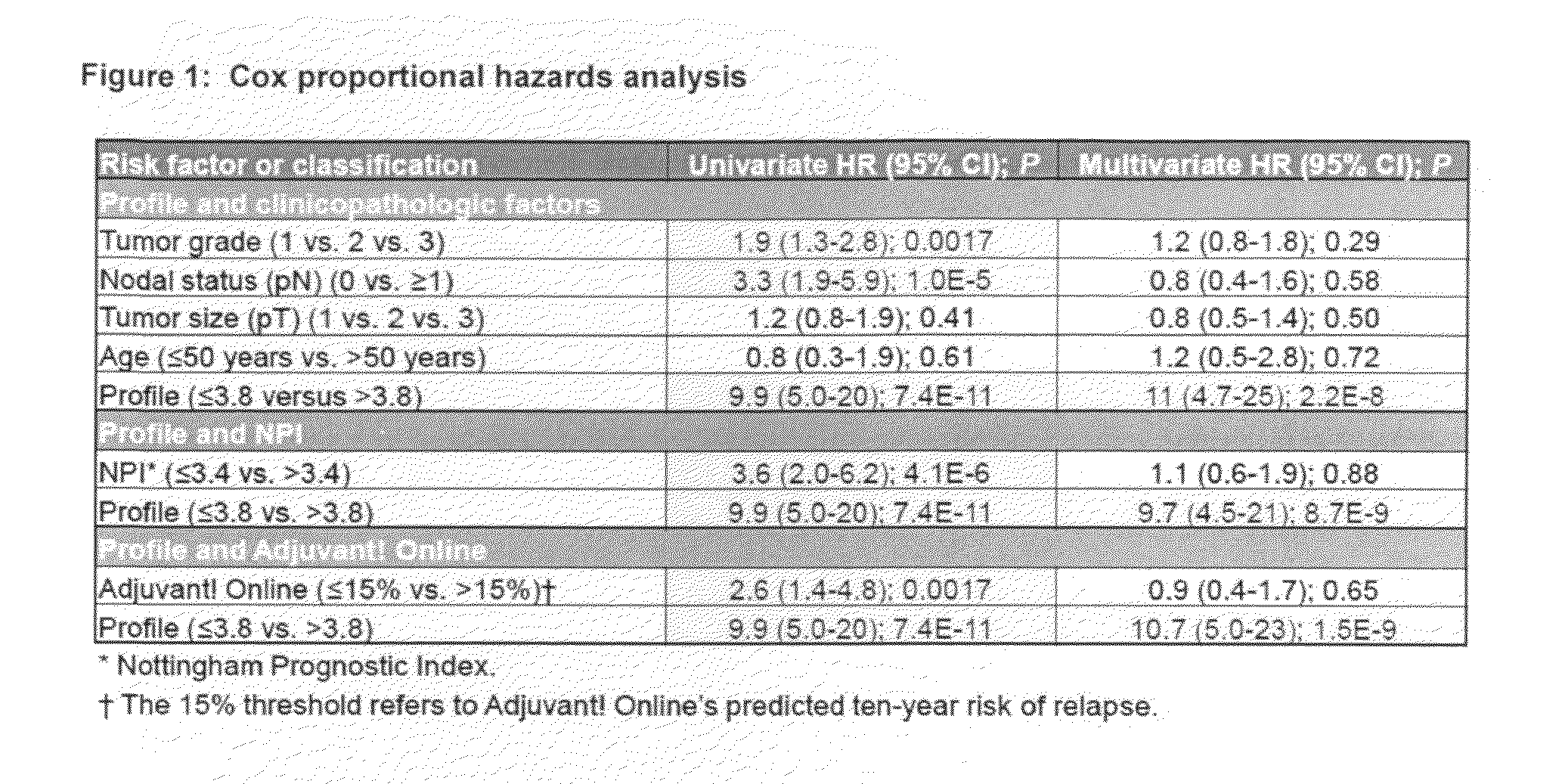

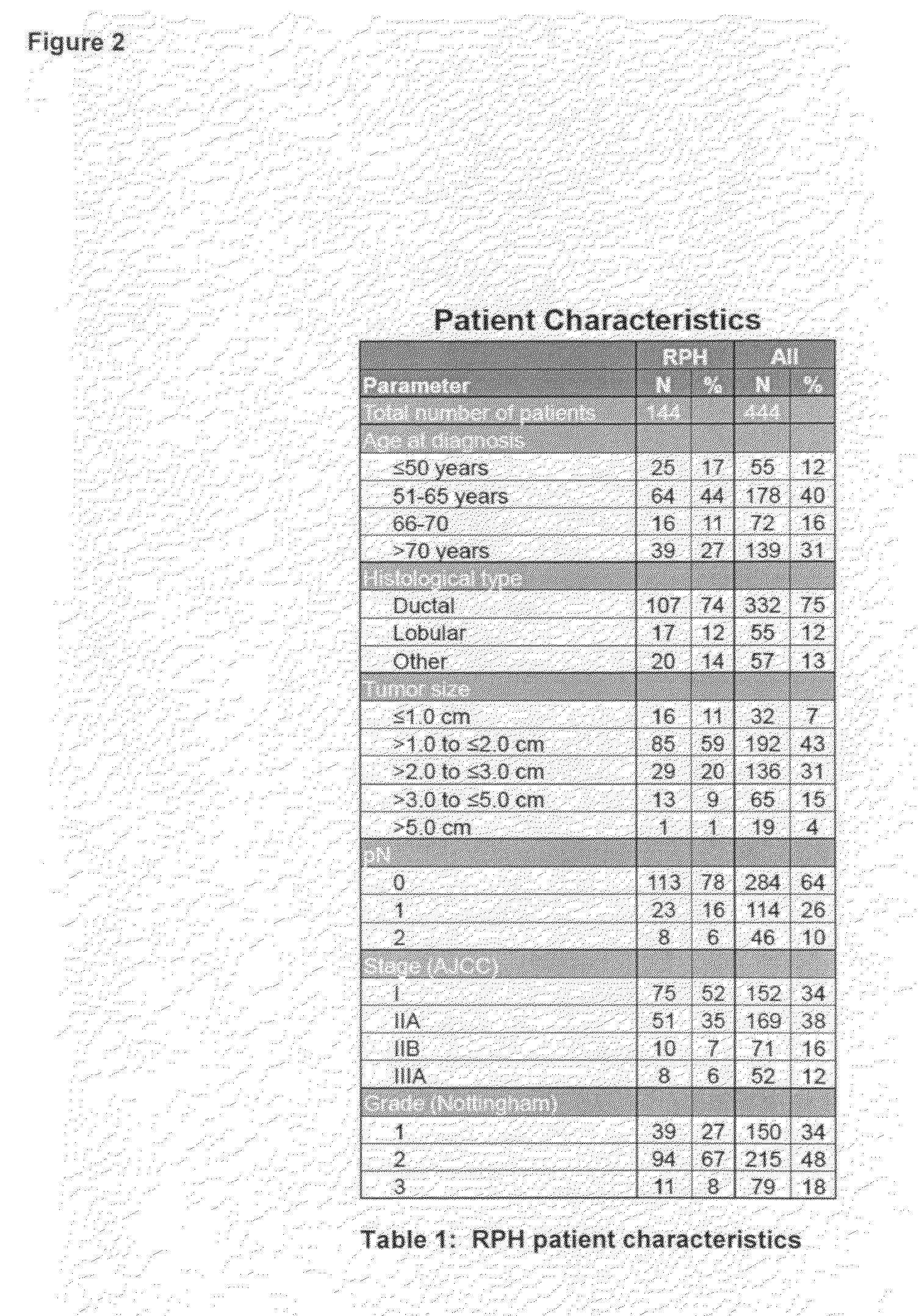

Molecular markers predicting response to adjuvant therapy, or disease progression, in breast cancer

Predicting response to adjuvant therapy or predicting disease progression in breast cancer is realized by (1) first obtaining a breast cancer test sample from a subject; (2) second obtaining clinicopathological data from said breast cancer test sample; (3) analyzing the obtained breast cancer test sample for presence or amount of (a) one or more molecular markers of hormone receptor status, one or more growth factor receptor markers, (b) one or more tumor suppression / apoptosis molecular markers; and (c) one or more additional molecular markers both proteomic and non-proteomic that are indicative of breast cancer disease processes; and then (4) correlating (a) the presence or amount of said molecular markers and, with (b) clinicopathological data from said tissue sample other than the molecular markers of breast cancer disease processes. A kit of (1) a panel of antibodies; (2) one or more gene amplification assays; (3) first reagents to assist said antibodies with binding to tumor samples; (4) second reagents to assist in determining gene amplification; permits, when applied to a breast cancer patient's tumor tissue sample, (A) permits observation, and determination, of a numerical level of expression of each individual antibody, and gene amplification; whereupon (B) a computer algorithm, residing on a computer can calculate a prediction of treatment outcome for a specific treatment for breast cancer, or future risk of breast cancer progression.

Owner:LINKE STEVEN +2

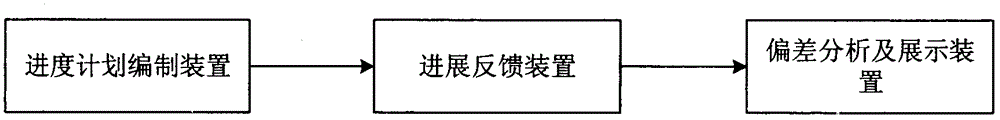

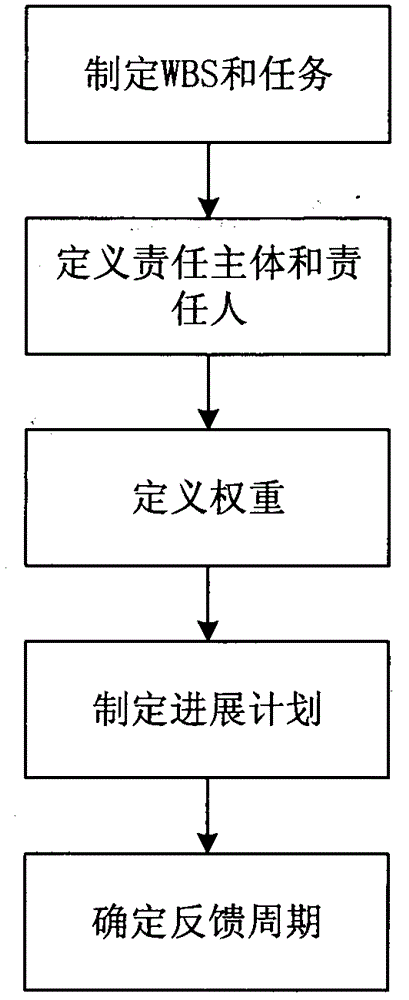

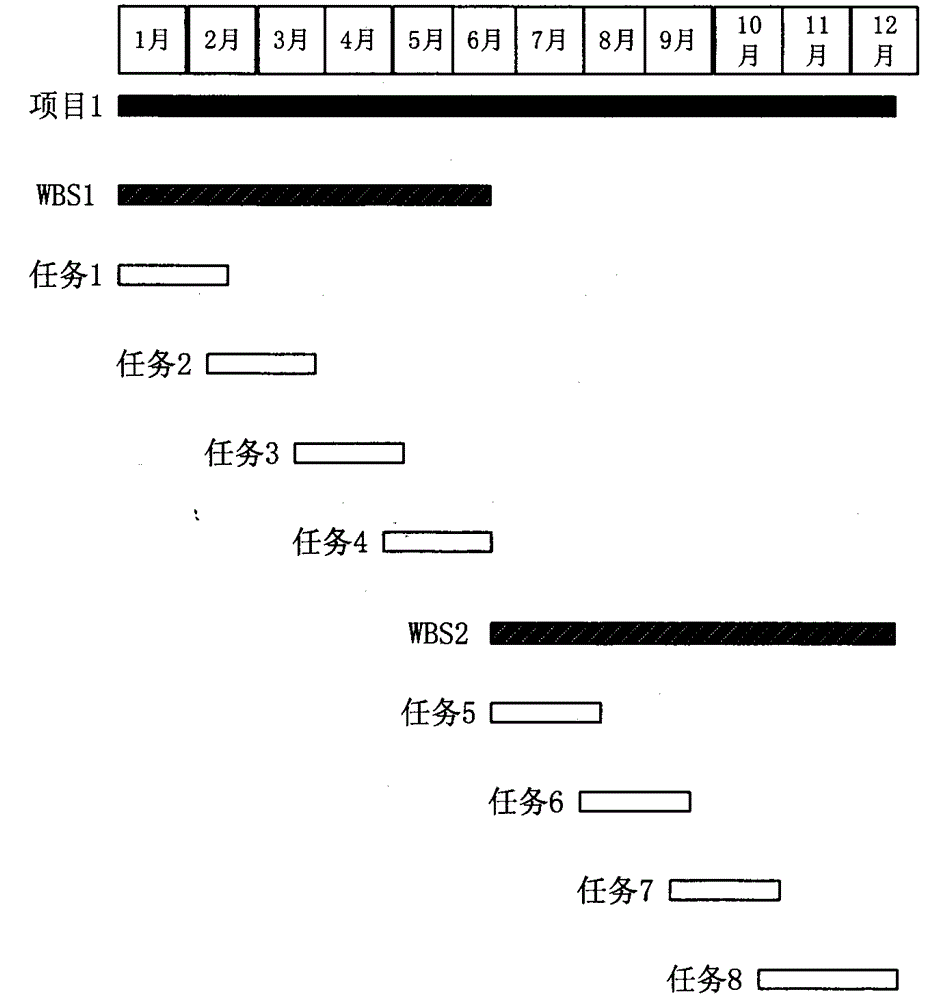

Method and system for project management process feedback and deviation analysis

ActiveCN104636880AEasy to controlImprove visualizationOffice automationResourcesGantt chartProject management process

The invention relates to a method and a system for project management process feedback and deviation analysis. The method comprises the following steps of 1, progress plan planning; 2, progress feedback; 3, deviation analysis and display. The method and the system have the advantages that the progress feedback realizing quantitative and qualitative combination is realized, meanwhile, the integral progress feedback integrating the generated problem, the current actual progress and the future risk is realized, the progress and the weight of all subordinate tasks are integrally considered, high-level stage WBS (work breakdown structure) and project actual progress are formed through summarizing, the task and WBS actual progress and time plan are used for comparison, and a respective actual execution deviation is formed, and is directly displayed in a Gantt chart.

Owner:南京远光广安信息科技有限公司

Adipogenic adenoviruses as a biomarker for disease

Owner:OBETECH LLC

Stock fluctuation prediction system

The present invention belongs to the information processing technical field and relates to a stock fluctuation prediction system. The system comprises a stock market information receiving module which is used for automatically receiving and updating the market data of all A-shares on each trading day, a stock fundamental data receiving module which is used for receiving and updating the fundamental data of all the A-shares regularly, a database integration and clearing module which is used for correlating and matching stock market information and stock fundamental information and clearing and correcting errors or deviations in an original database, and a fluctuation prediction model analysis and update module which is used for establishing a fluctuation rate prediction model, analyzing and calculating the data to obtain risk data and data updates. According to the stock fluctuation prediction system of the resent invention, the future risk of investment portfolios can be predicted based on the predictability of the model, so that investors can be facilitated to do the better beforehand risk management.

Owner:四川倍发科技有限公司

Building engineering comprehensive data acquisition, analysis and remote uploading system

PendingCN110310210ASolve pain pointsRealize all-round real-time monitoringData processing applicationsAlarmsVideo monitoringObservation data

The invention discloses a building engineering comprehensive data acquisition, analysis and remote uploading system. The system comprises a cloud server, an engineering data acquisition system, a construction site data transfer machine, a terminal system, a video monitoring system and a face recognition access control system. The system is used for collecting the original observation data from different devices, decoding the data of different devices, integrating and interweaving the data into one kind of information, the information is transmitted to a server via a network, and the server compares and processes the various kinds of information via a specific algorithm, analyzes the correctness and the future risk condition of the information and arranges and feeds back the information toa terminal user.

Owner:广西越知网络股份有限公司

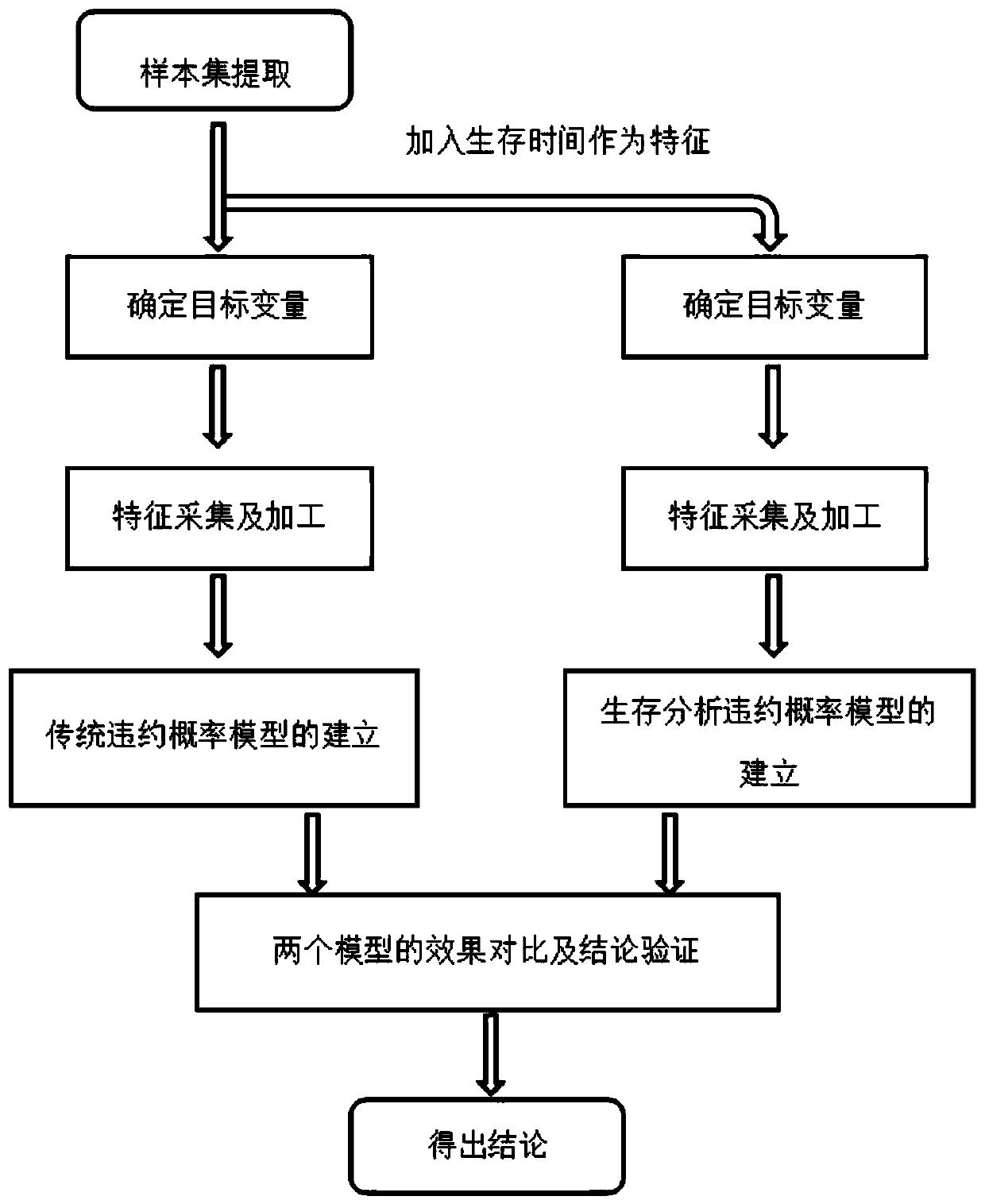

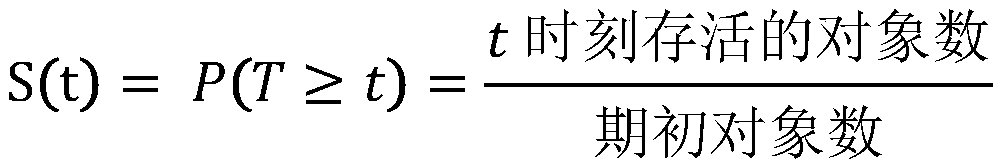

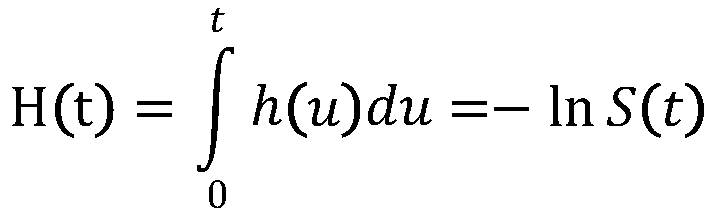

Consumption staging default probability model based on survival analysis

PendingCN110689427AHealthy and continuous consumption installment businessAccurate predictionFinanceEnsemble learningSurvival analysisData mining

The invention discloses a consumption staging default probability model based on survival analysis. The model is characterized in that the number of consumption staging repayment periods is regarded as discrete survival time, the discrete survival time is added into the user attribute characteristics and then the discrete survival time is fused into a default model, the relationship between a sample survival result and the survival time and the user attribute characteristics is researched, and a model capable of predicting the default probability of the consumption staging loan user in any future period is established by using an xgboost algorithm; a danger function of survival analysis is obtained through the default probability model, the default probability of any loan user in any period is predicted based on the danger function, and the future default risk of the loaned user is evaluated at the same time. According to the invention, the possibility that the user is overdue betweenthe end of the observation period and the full period neglected by the traditional model is covered, so that the future risk is estimated more accurately, and the financial institution can develop theconsumption staging business more healthily and continuously.

Owner:杭州绿度信息技术有限公司

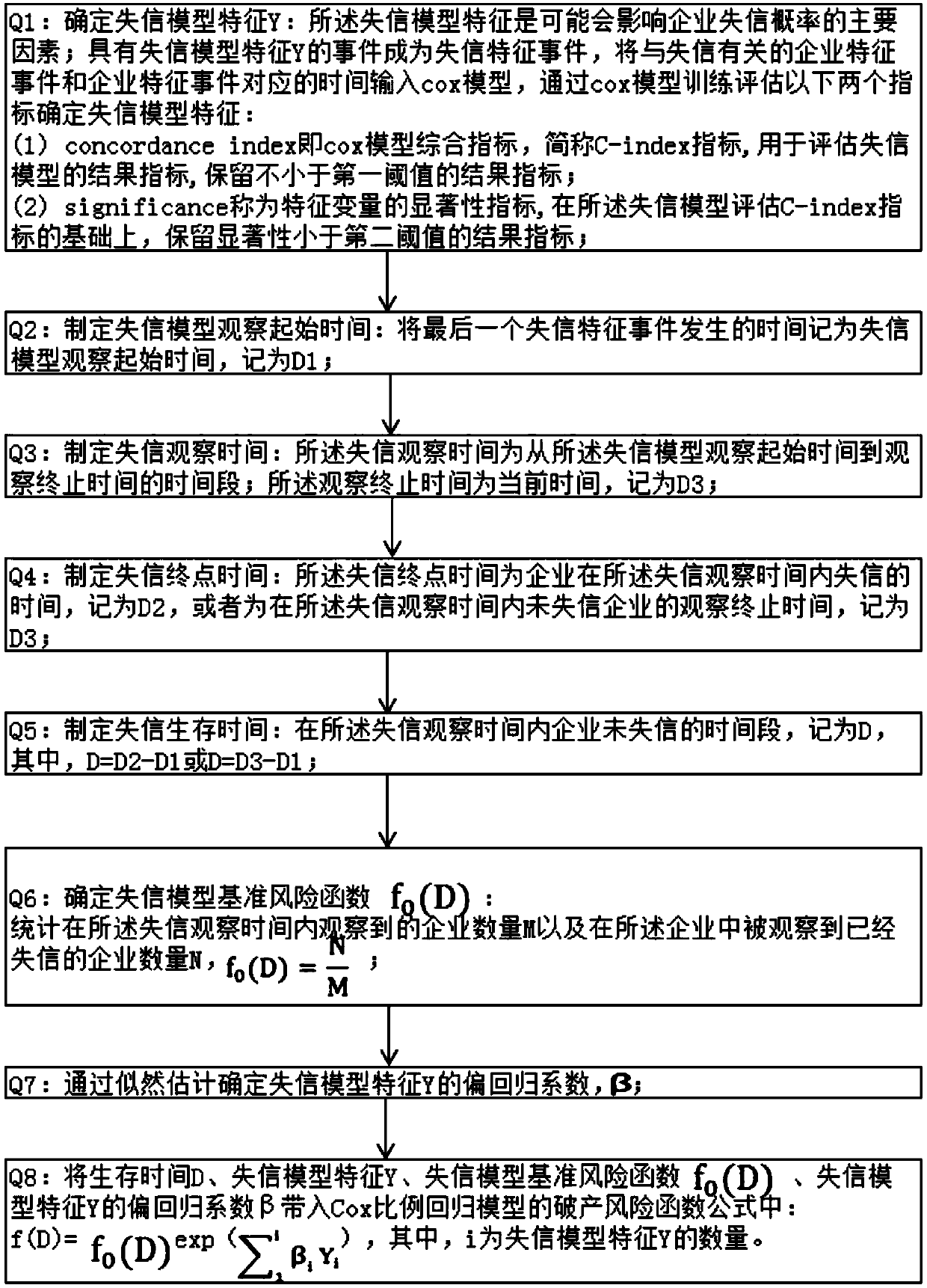

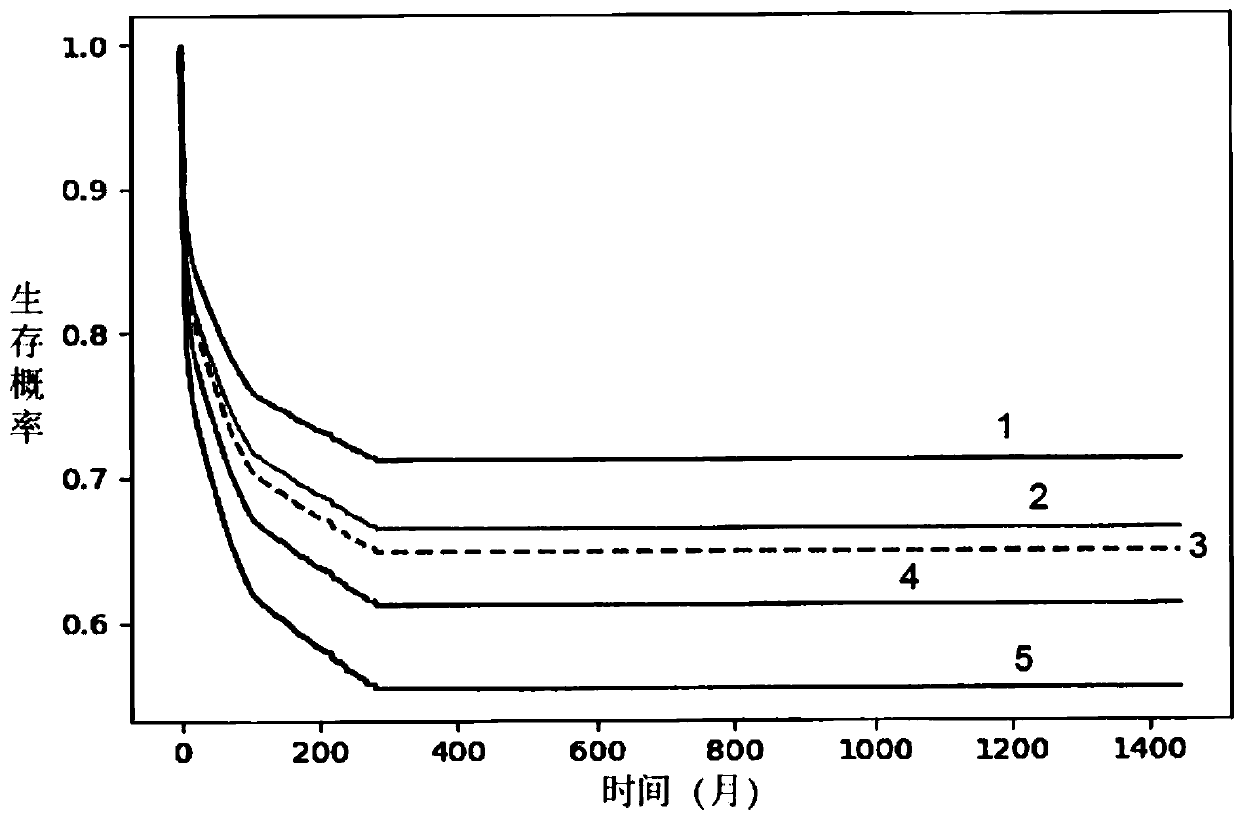

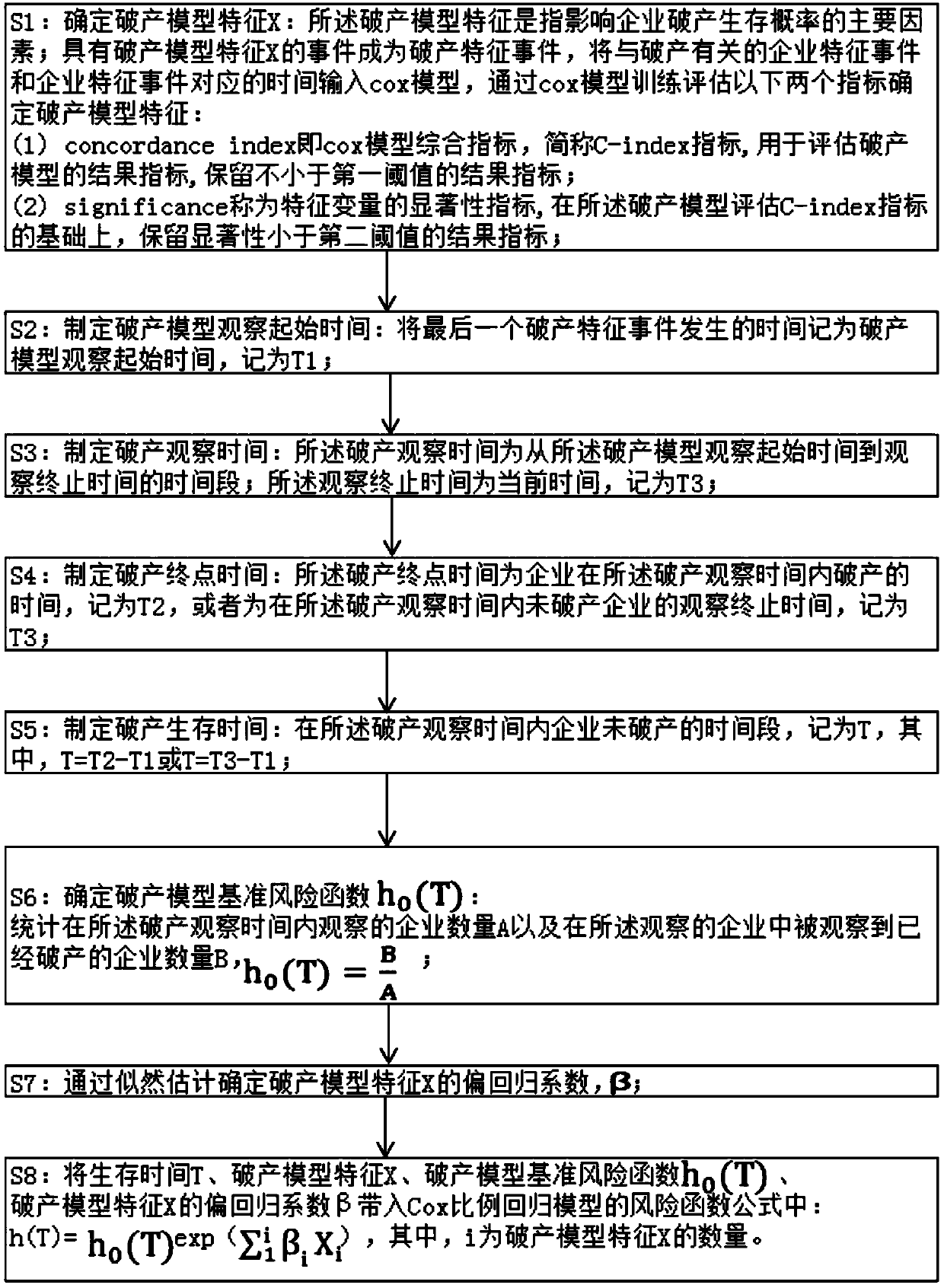

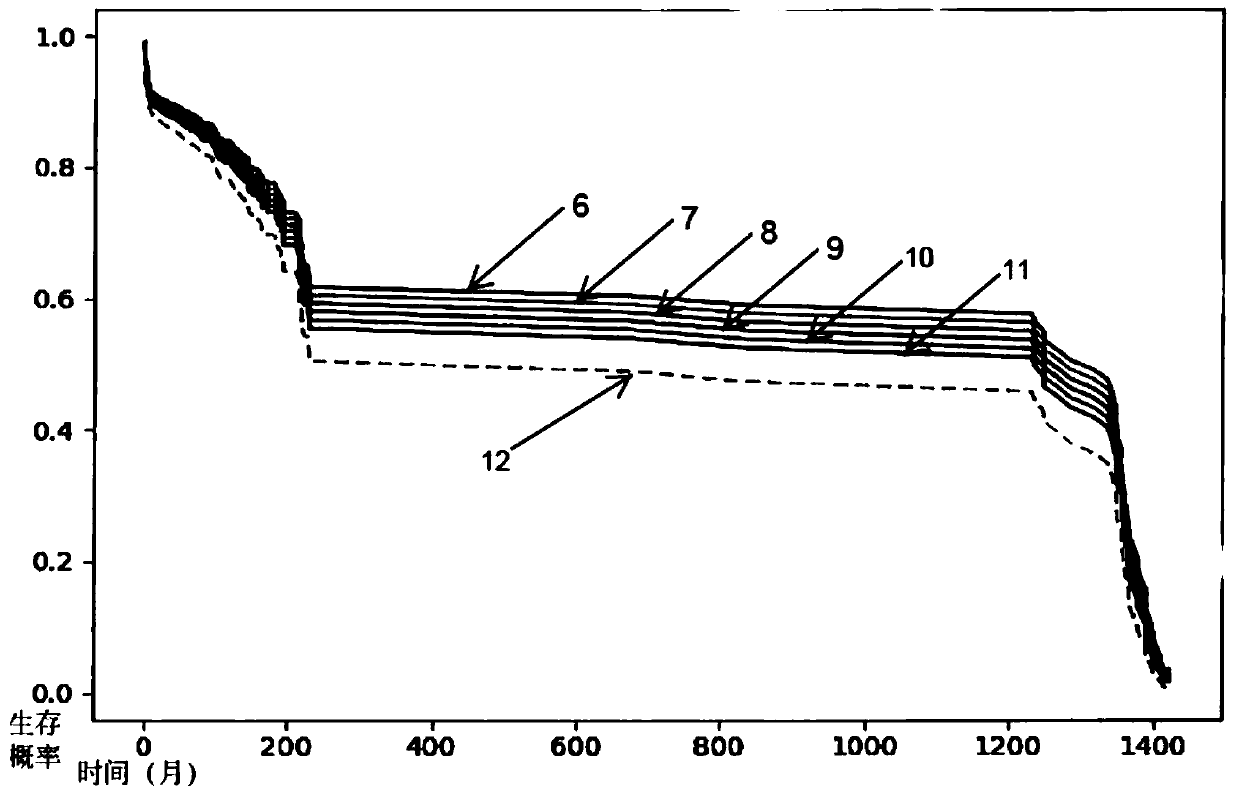

enterprise risk trust loss model based on Cox regression prediction

The invention discloses an enterprise risk trust loss model based on Cox regression prediction. the lost credit survival probability of the lost credit model is calculated; f (D), using an enterprisecredit model feature Y as a covariable or an interaction item; The construction method of the lost credit model comprises the following steps of: constructing a lost credit model; Q1, determining a feature Y of the lost credit model, Q2: formulating a lost credit model observation starting time D1; Q3: formulating a lost credit observation time D3; Q4: formulating a lost credit end point time D2 or D3; Q5, formulating a lost credit survival time D; Q6, determining a reference risk function f0 (D) of the lost trust model; Q7, determining a partial regression coefficient of the characteristic Yof the lost trust model through likelihood estimation; Q8, brining The survival time D, the untrustworthy model feature Y, the untrustworthy model reference risk function f0(D), and the partial regression coefficient Beta of the untrustworthy model feature Y into the unbalanced risk function formula of the Cox proportional regression model. According to the model disclosed by the invention, the future risk change trend of an enterprise can be predicted, so that the possibility of enterprise credit risk occurrence can be predicted. The model disclosed by the invention has the advantages that the risk change trend of the enterprise can be predicted.

Owner:重庆誉存科技有限公司

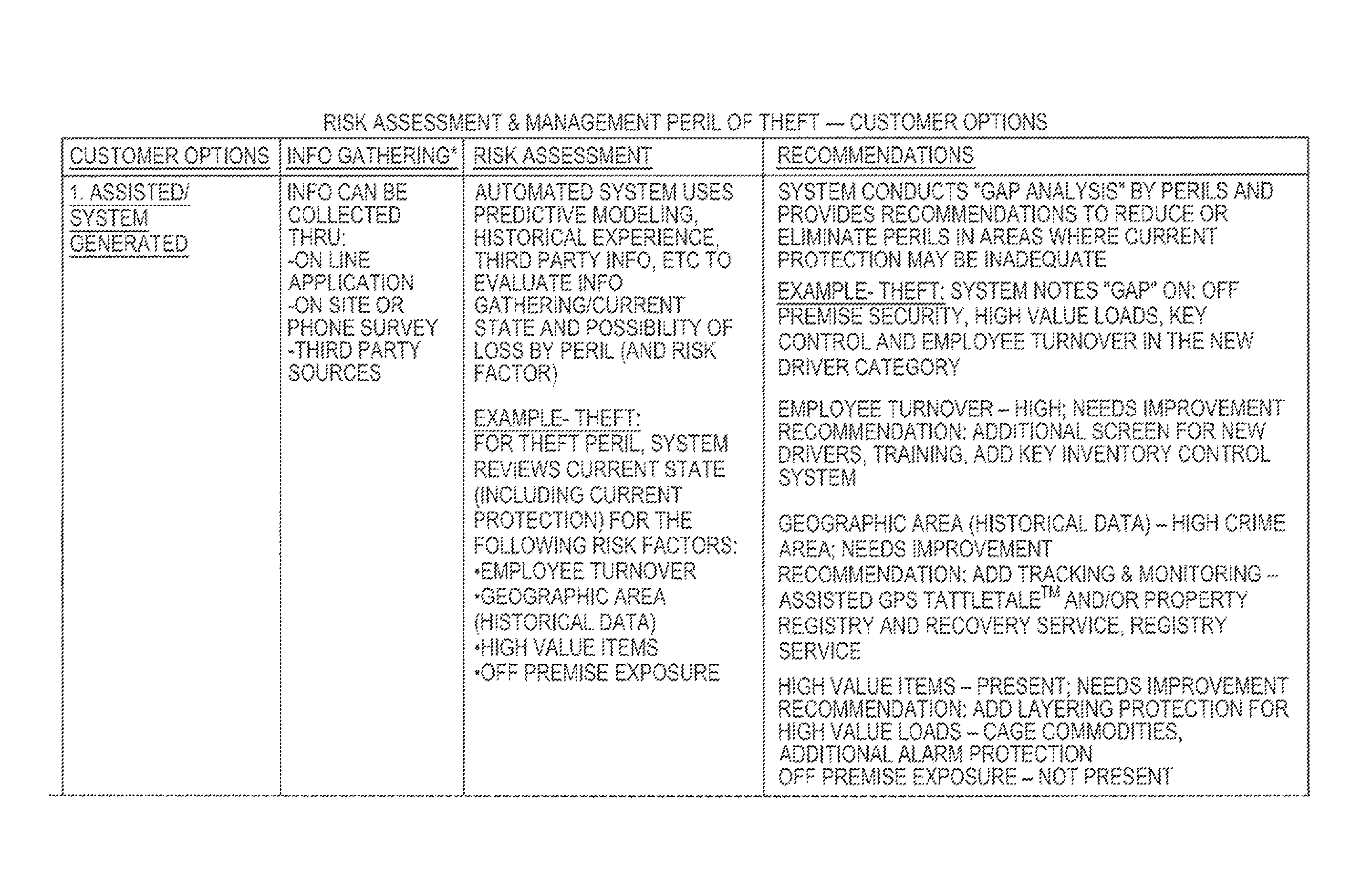

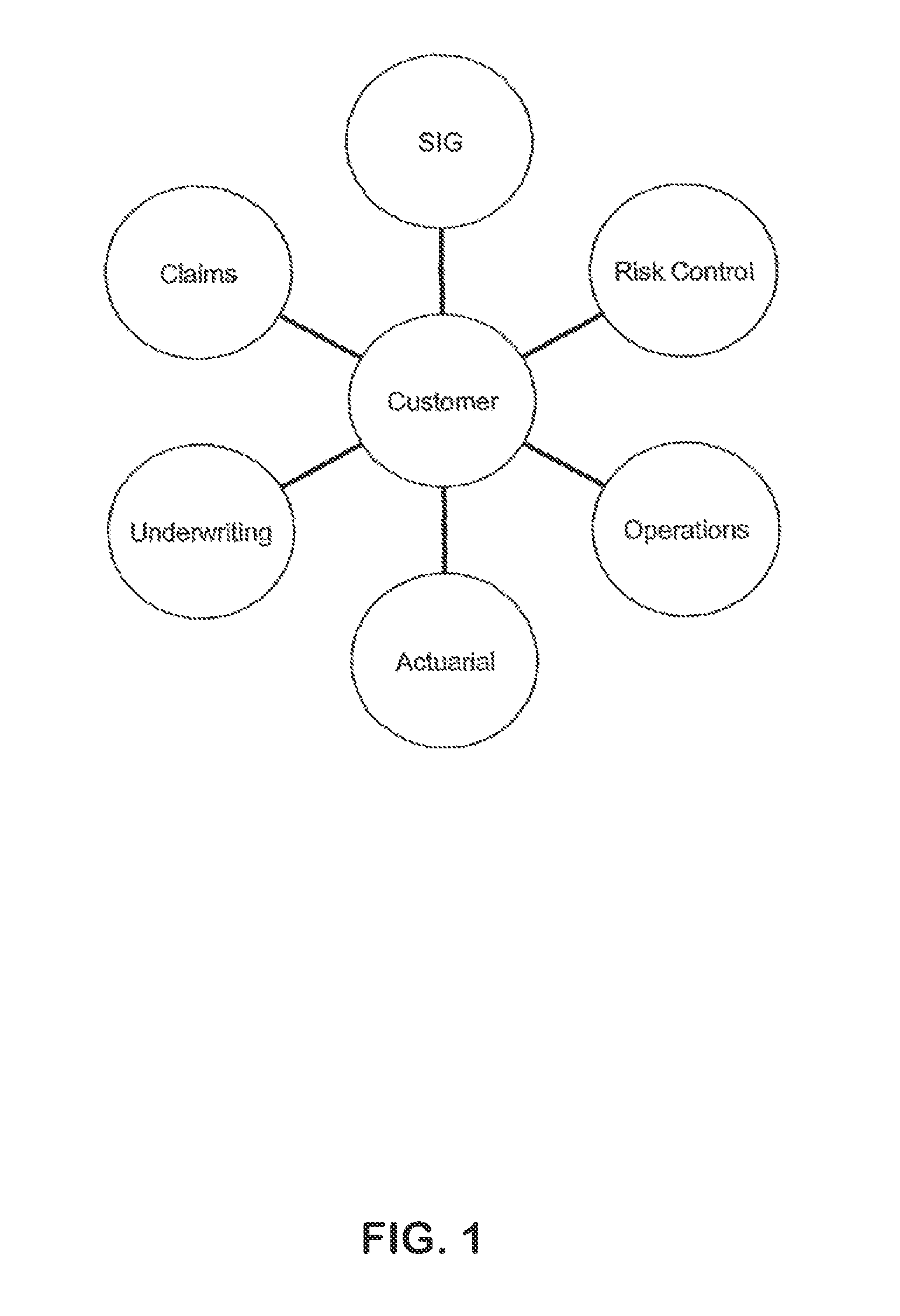

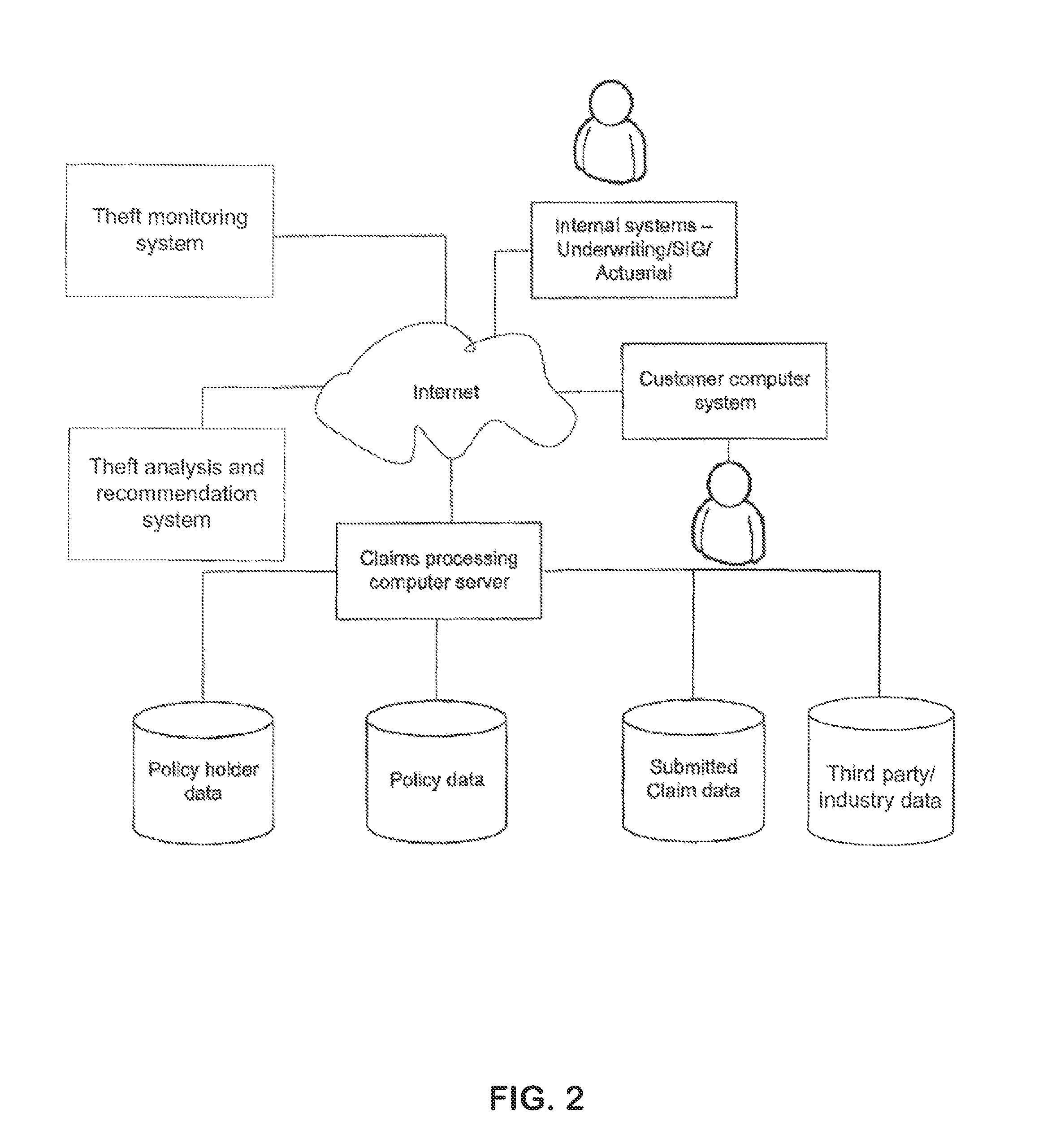

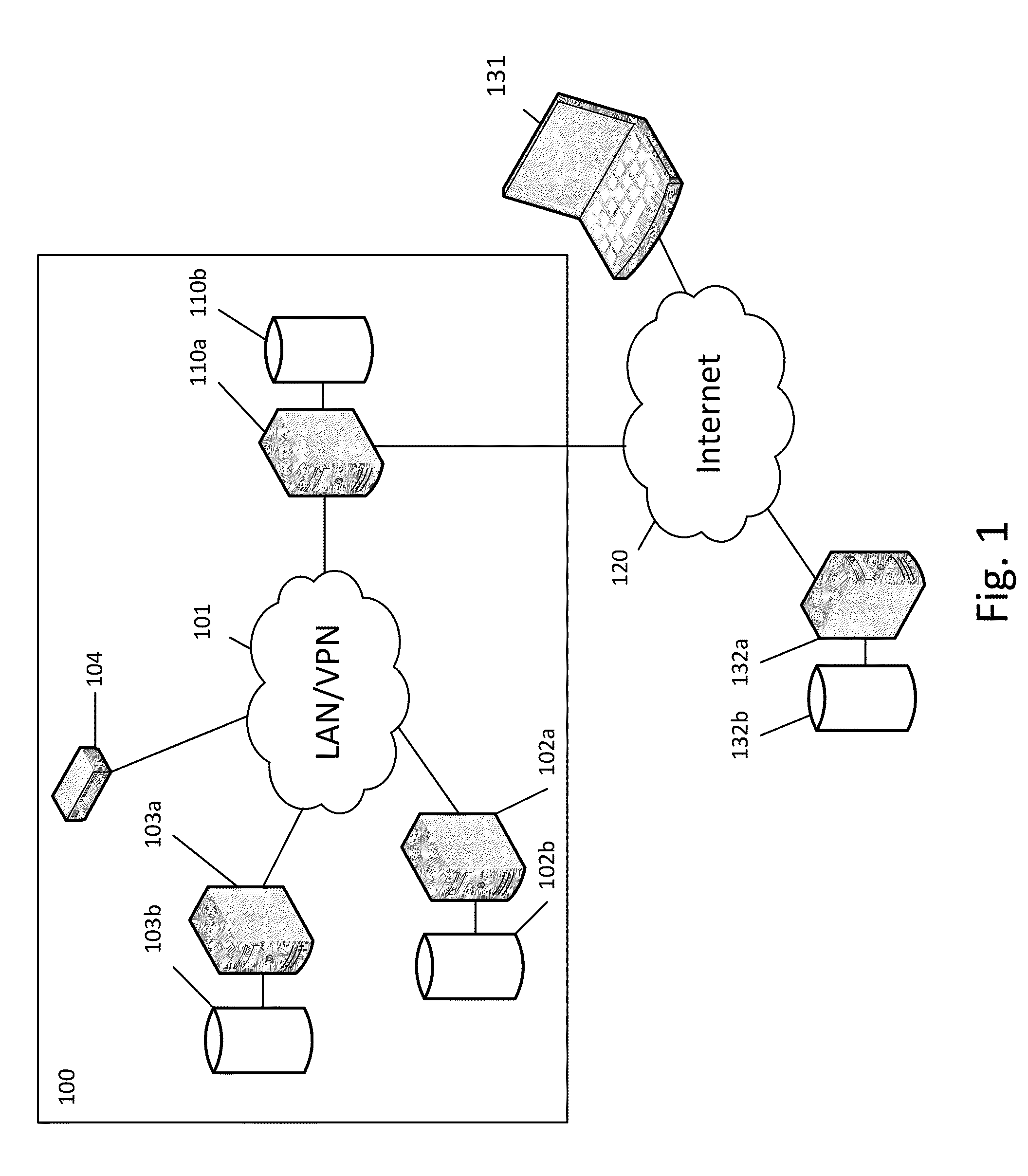

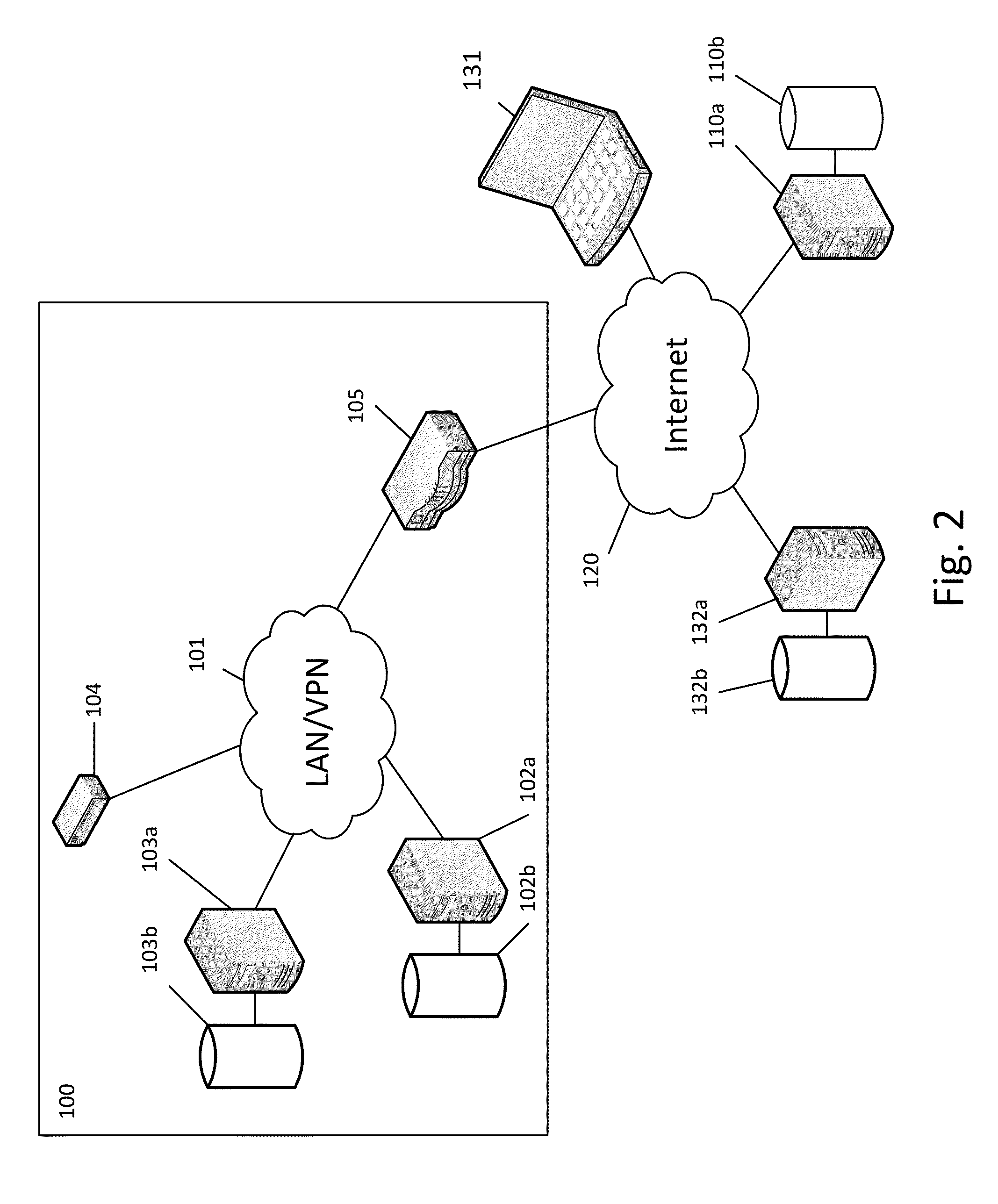

Methods and systems for providing customized risk mitigation/recovery to an insurance customer

A loss mitigation computer system includes a customer interface electronically receiving customer information data from a customer computer system via a communications network, a risk assessment computer processing module processing the customer information data and identifying at least one peril associated with the customer information data, a risk mitigation computer processing module generating at least one risk mitigation option based on the at least one peril and receiving customer selected risk mitigation options responsive to the generated at least one risk mitigation option from the customer computer system; and a customization computer processing module generating at least one of a calculated insurance premium, a current risk assessment, a future risk assessment, recommendations, and a gap analysis based on the received at least one customer selected risk mitigation option. Various alternative embodiments are also disclosed, including a computer implemented loss mitigation method and / or loss recovery system.

Owner:THE TRAVELERS INDEMNITY

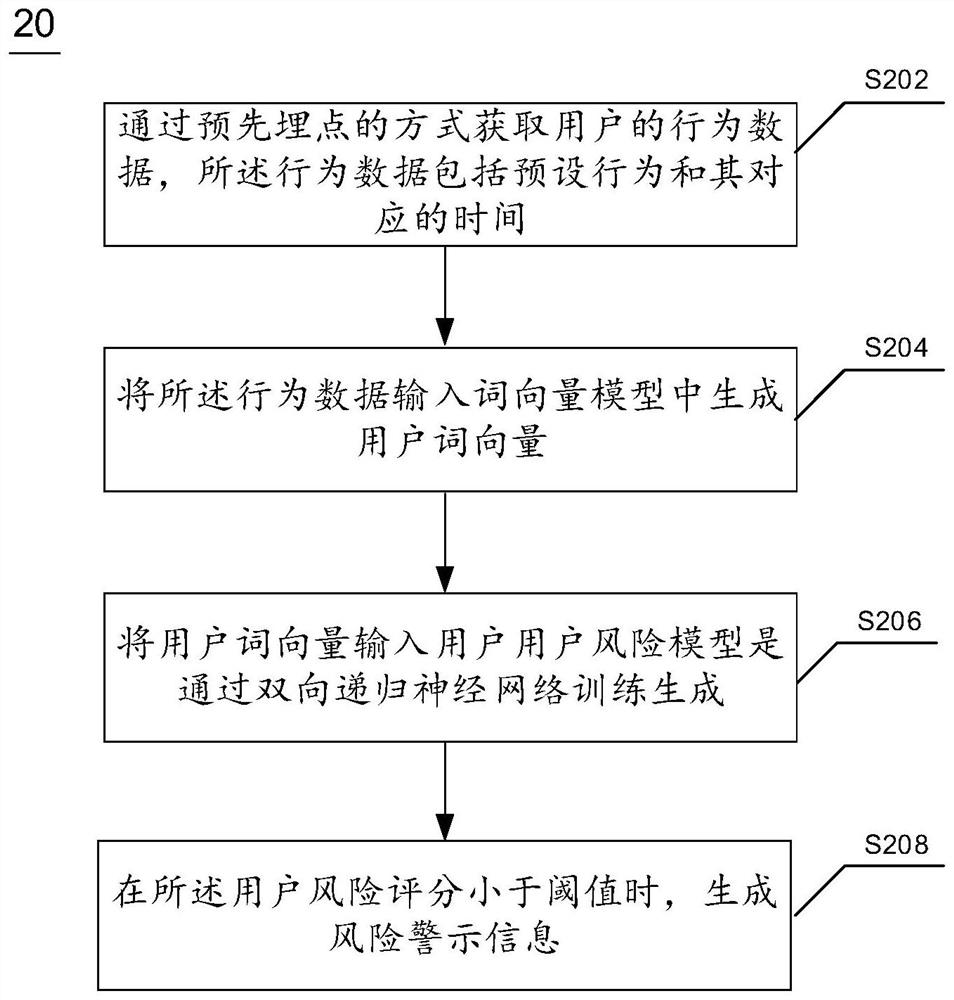

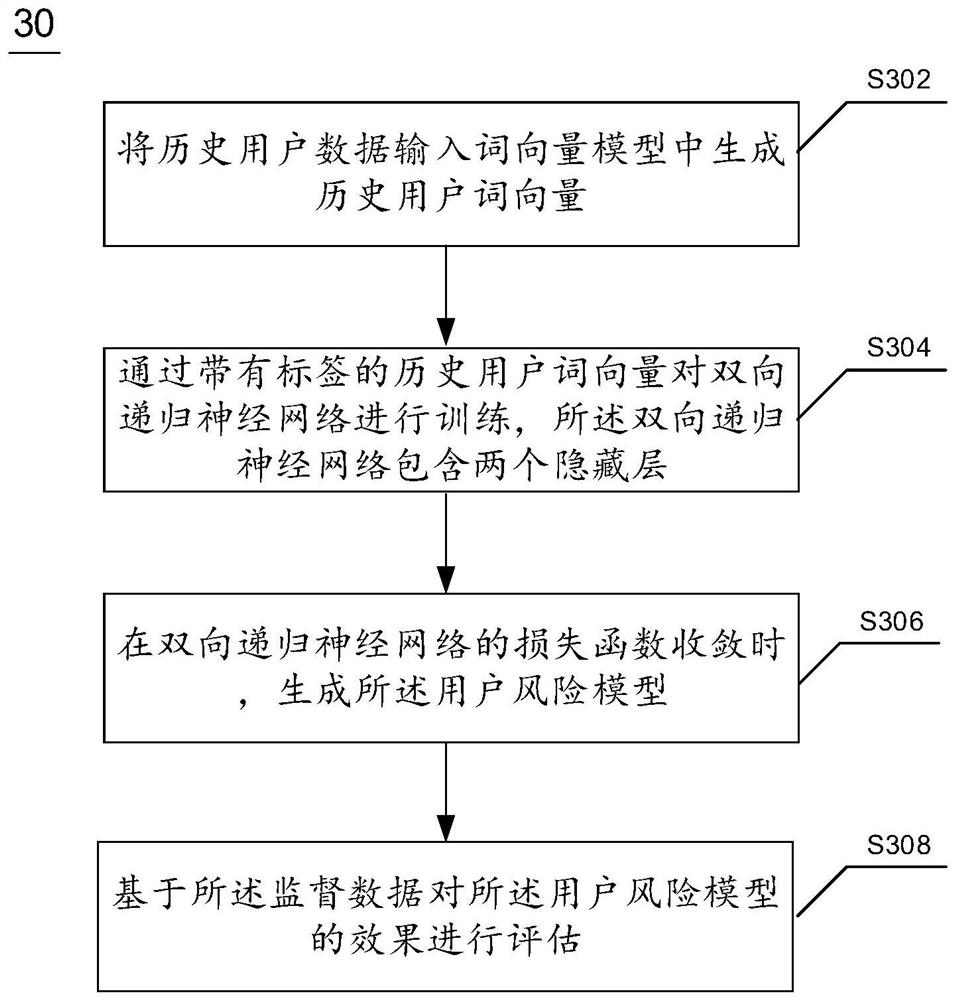

Method and device for generating risk warning information and electronic equipment

PendingCN112348660AReduce resource lossReduce lossesFinanceCharacter and pattern recognitionBusiness enterpriseBehavioral data

The invention relates to a method and device for generating risk warning information based on user behavior data, electronic equipment and a computer readable medium. The method comprises the steps ofobtaining behavior data of a user in a point pre-burying mode, wherein the behavior data comprises a preset behavior and corresponding time; inputting the behavior data into a word vector model to generate a user word vector; inputting the user word vector into a user risk model to generate a user risk score, the user risk model being generated through bidirectional recurrent neural network training; and when the user risk score is smaller than a threshold, generating risk warning information. According to the method and device for generating the risk warning information based on the user behavior data, the electronic equipment and the computer readable medium, historical information of a user account is not depended on, the future risk behavior of the user can be recognized only according to the user behavior data, then early warning is conducted in advance, and enterprise resource losses are reduced.

Owner:SHANGHAI QIYUE INFORMATION TECH CO LTD

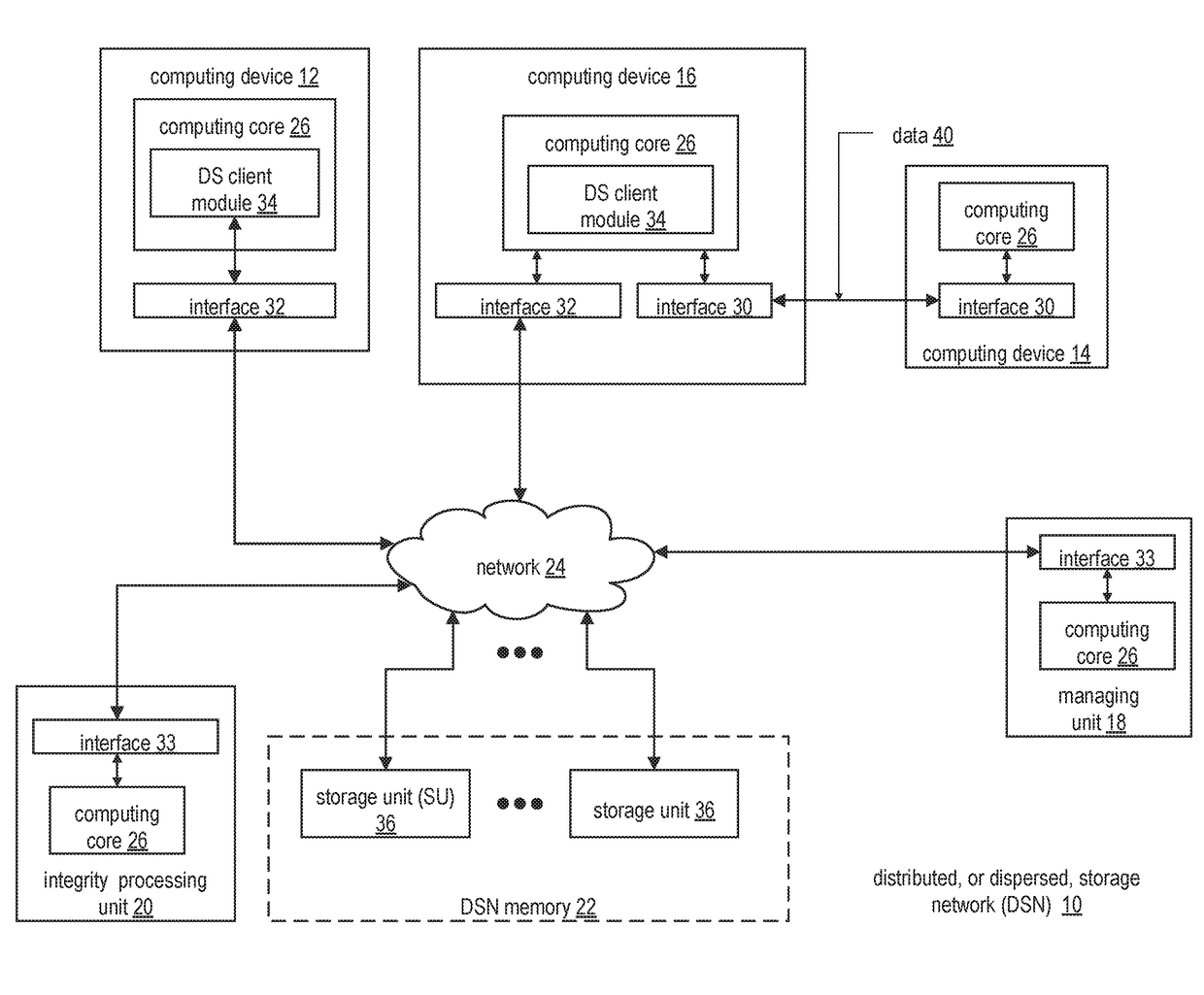

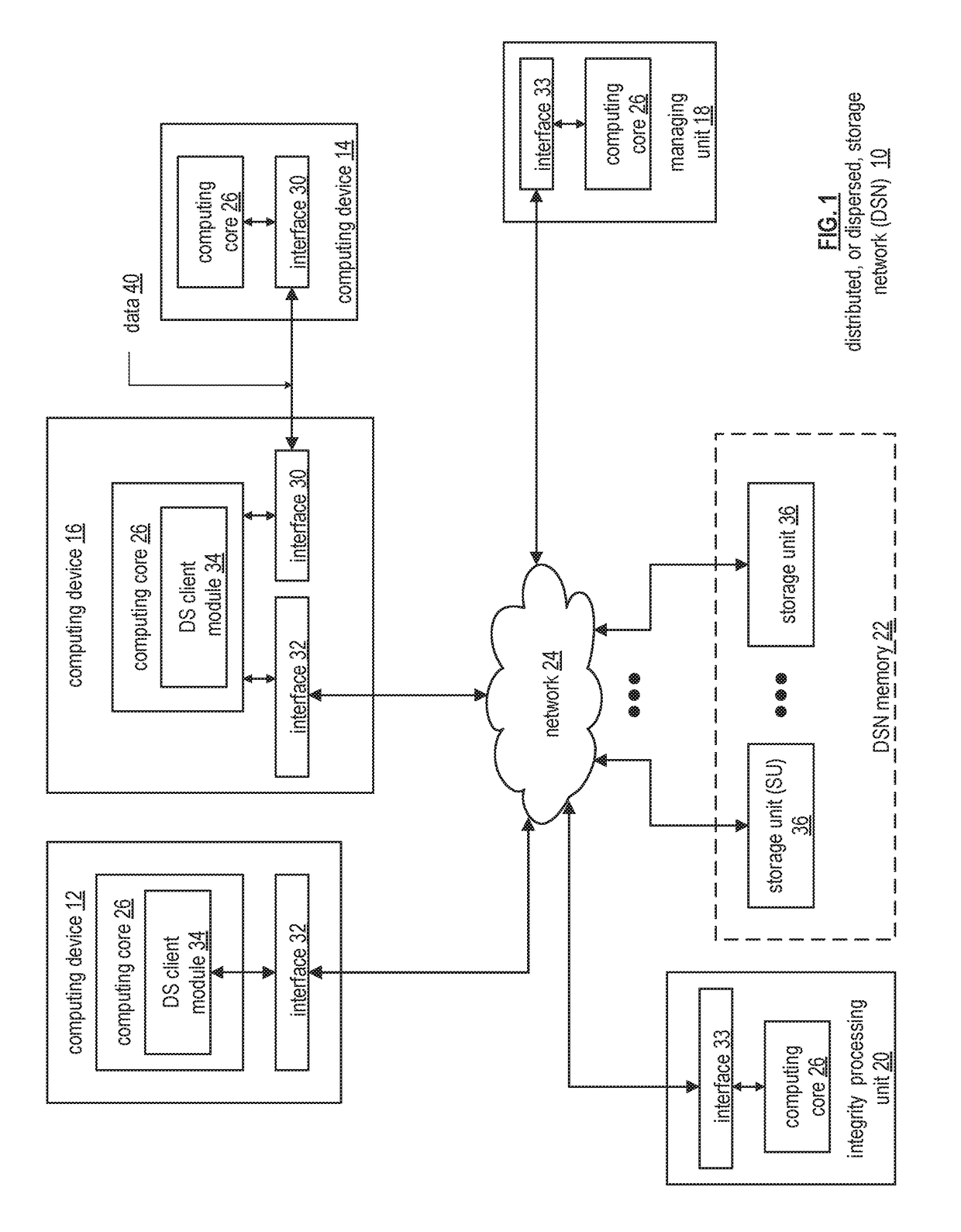

Prioritizing rebuilding based on a longevity estimate of the rebuilt slice

A method begins by determining to rebuild a slice or slices to at least one of multiple distributed storage network (DSN) memory locations. The method continues by calculating a future risk estimation of each one of the multiple DSN memory locations, the future risk estimation including one or more risk factors. The method continues by determining a selection of which of the multiple DSN memory locations to rebuild and rebuilding the slice in the DSN memory of the selection.

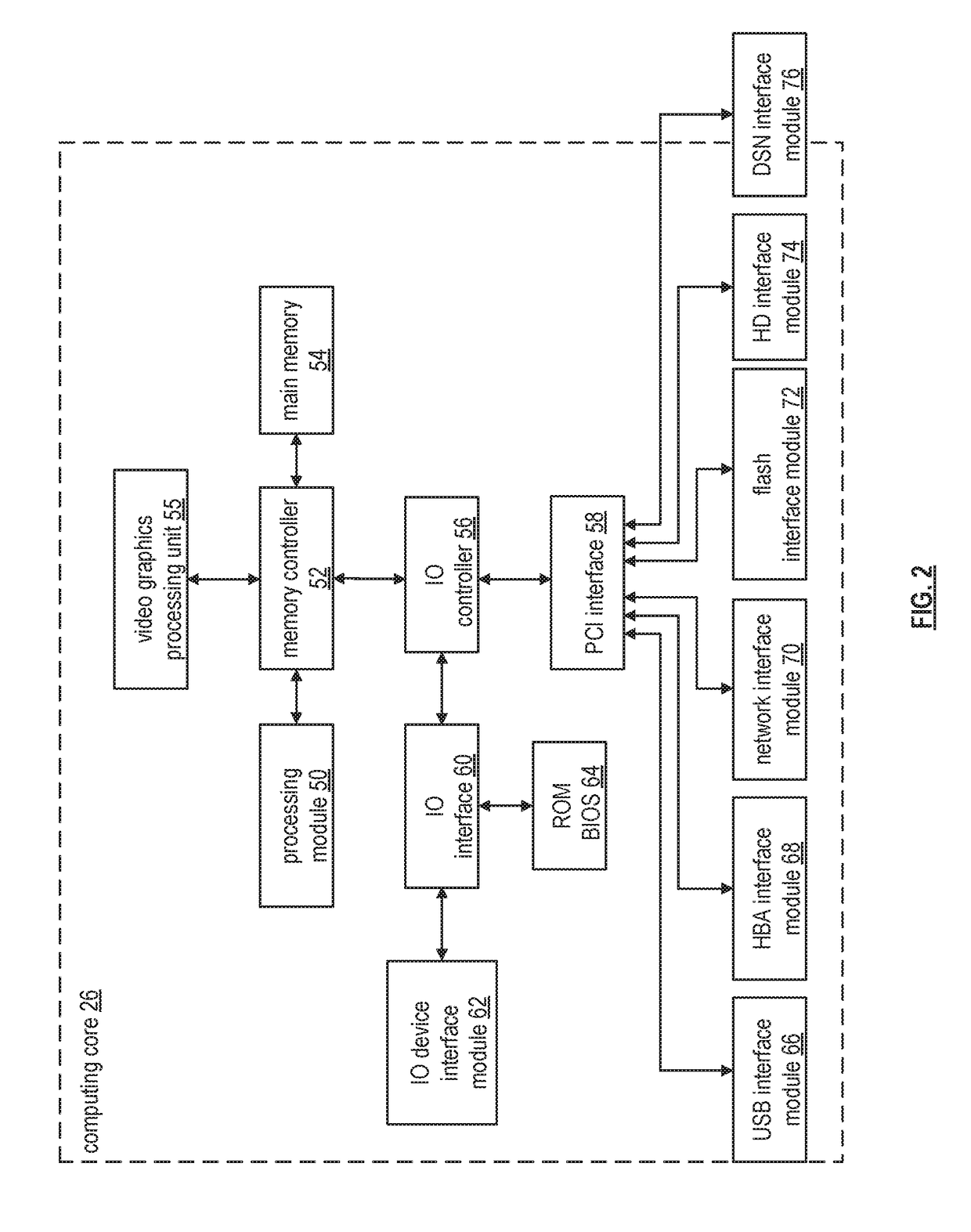

Owner:IBM CORP

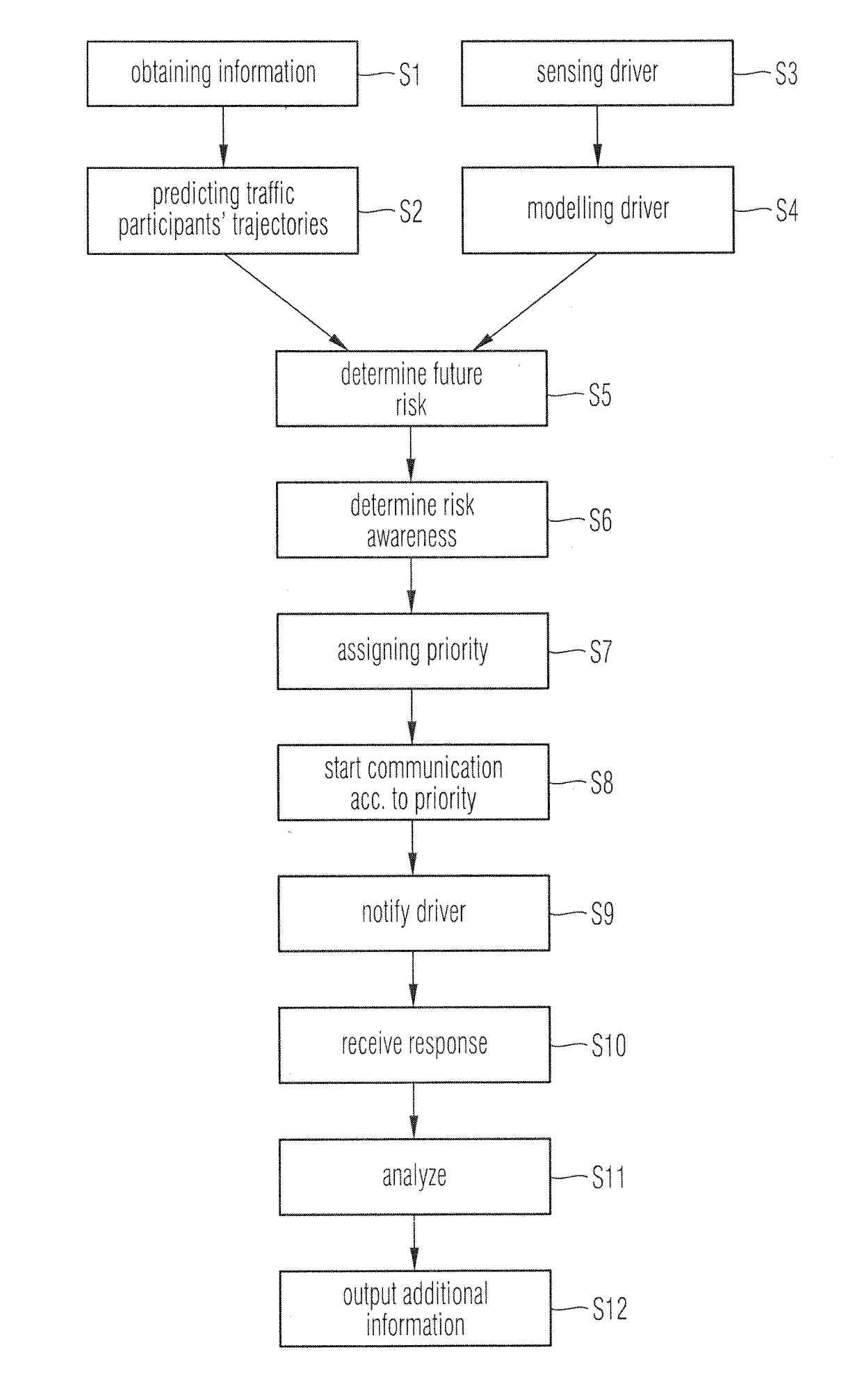

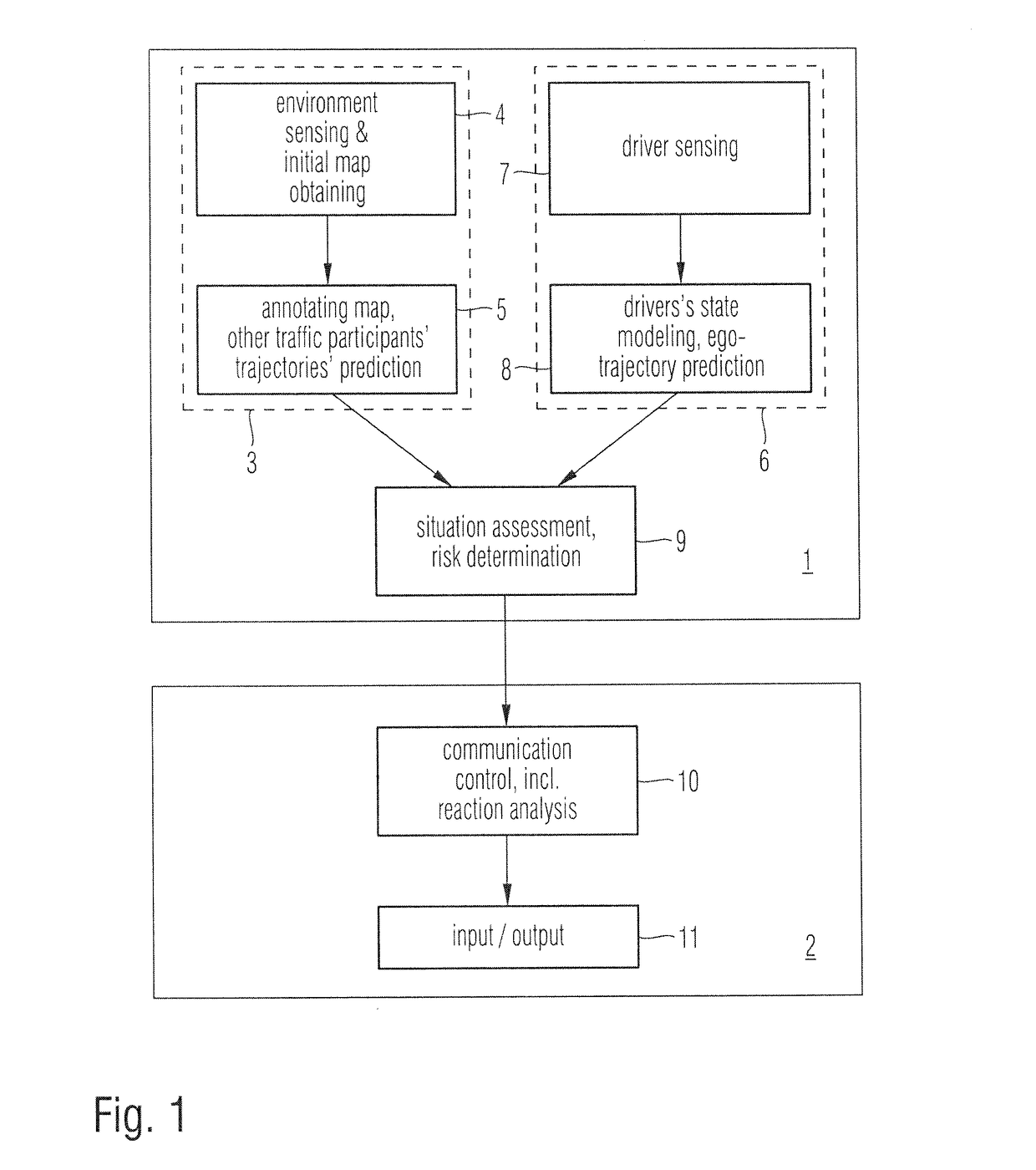

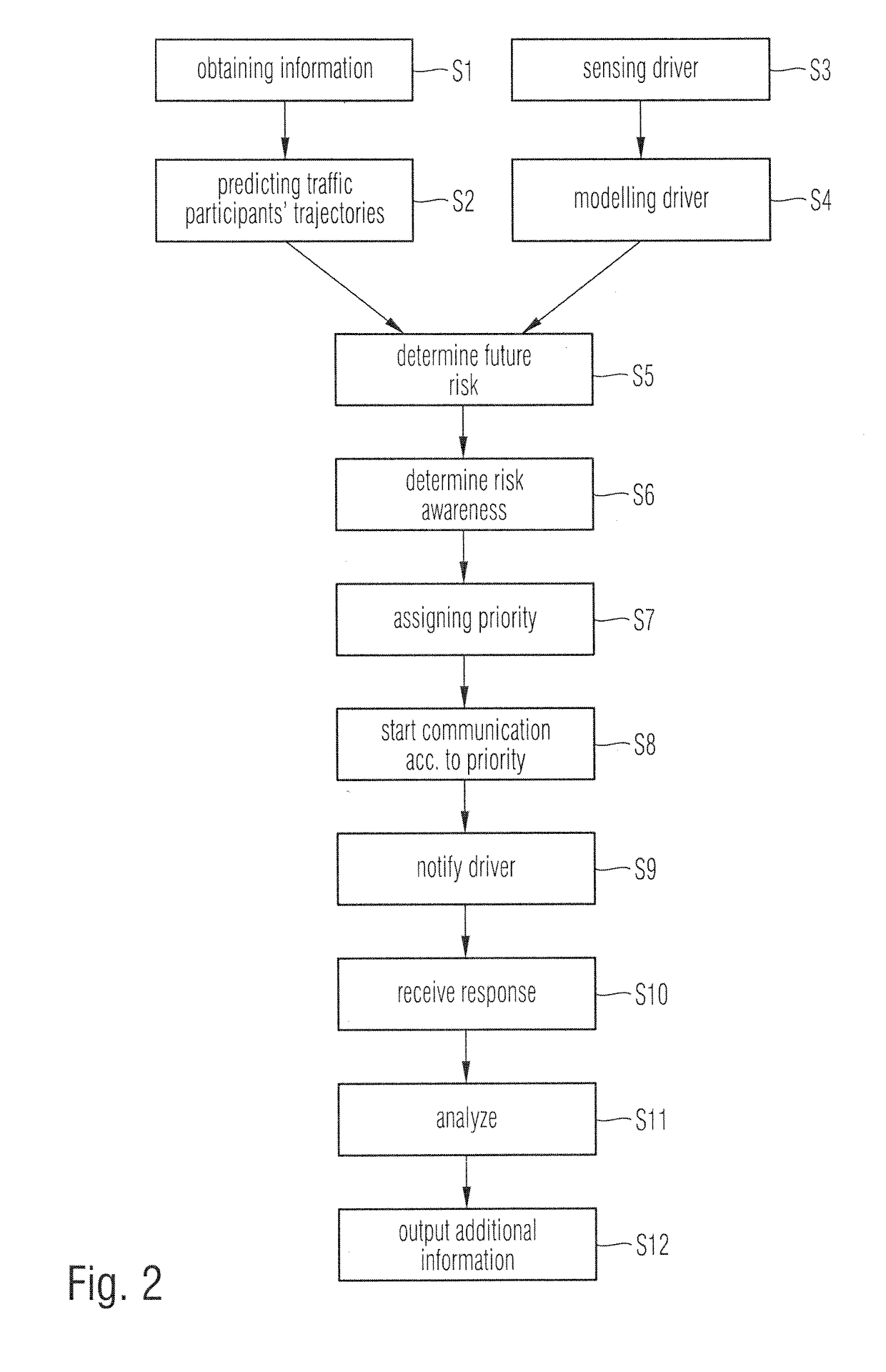

Method and system for improving a traffic participant's attention

ActiveUS20170148318A1Efficiently assistRaise attentionAnti-collision systemsAcquiring/recognising eyesTraffic conditionsTraffic scene

A method and a system for improving a traffic participant's attention is such that, at first, information on the traffic scene that is encountered by the traffic participant is obtained. From the obtained information a traffic situation development is predicted. A measure for at least on future risk in the predicted traffic situation development is determined and a communication with the traffic participant is started. The communication comprises a first step of notifying the traffic participant and a second step of providing additional information in response to the traffic participants reaction to the notification which includes some information on the determined future risk.

Owner:HONDA RES INST EUROPE

System and Method for Assessing Risk and Marketing Potential Using Industry-Specific Operations Management Transaction Data

InactiveUS20160253608A1Strong specificityImprove risk profileMarket predictionsFinanceTransaction dataComputerized system

The present invention relates generally to the analysis and use of operations management, facility management, and / or security system transaction data in the field of computerized systems and methods for processing data related to insurance and finance to determine future risk associated with a specific entity's predicted property and casualty losses or credit losses. More specifically, the invention relates to a system and method for incorporating transaction oriented data from operations management, facility management, and / or security systems into insurance and finance risk assessment underwriting, pricing / quoting, and retention management.

Owner:DIMARTINO JOSEPH

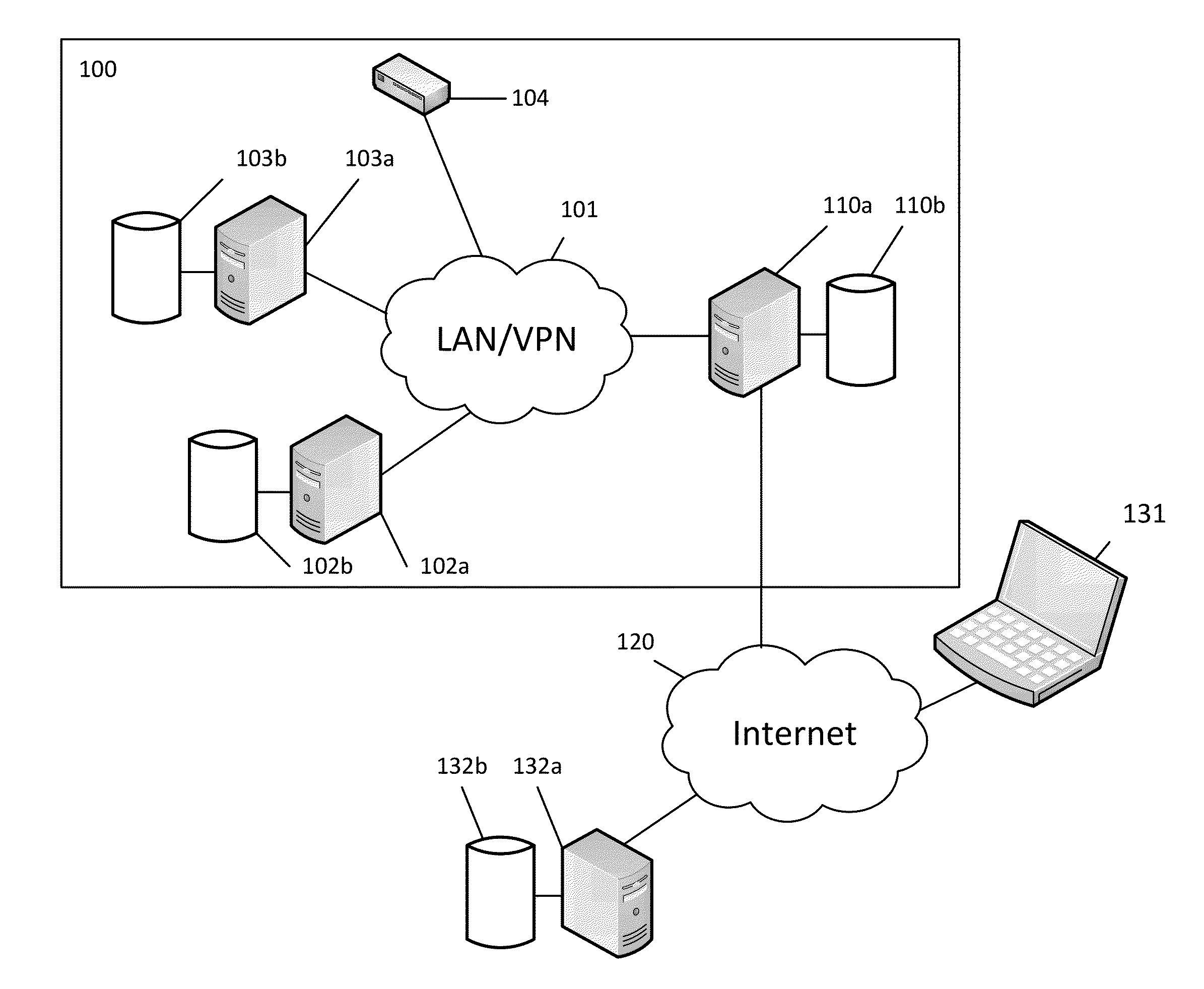

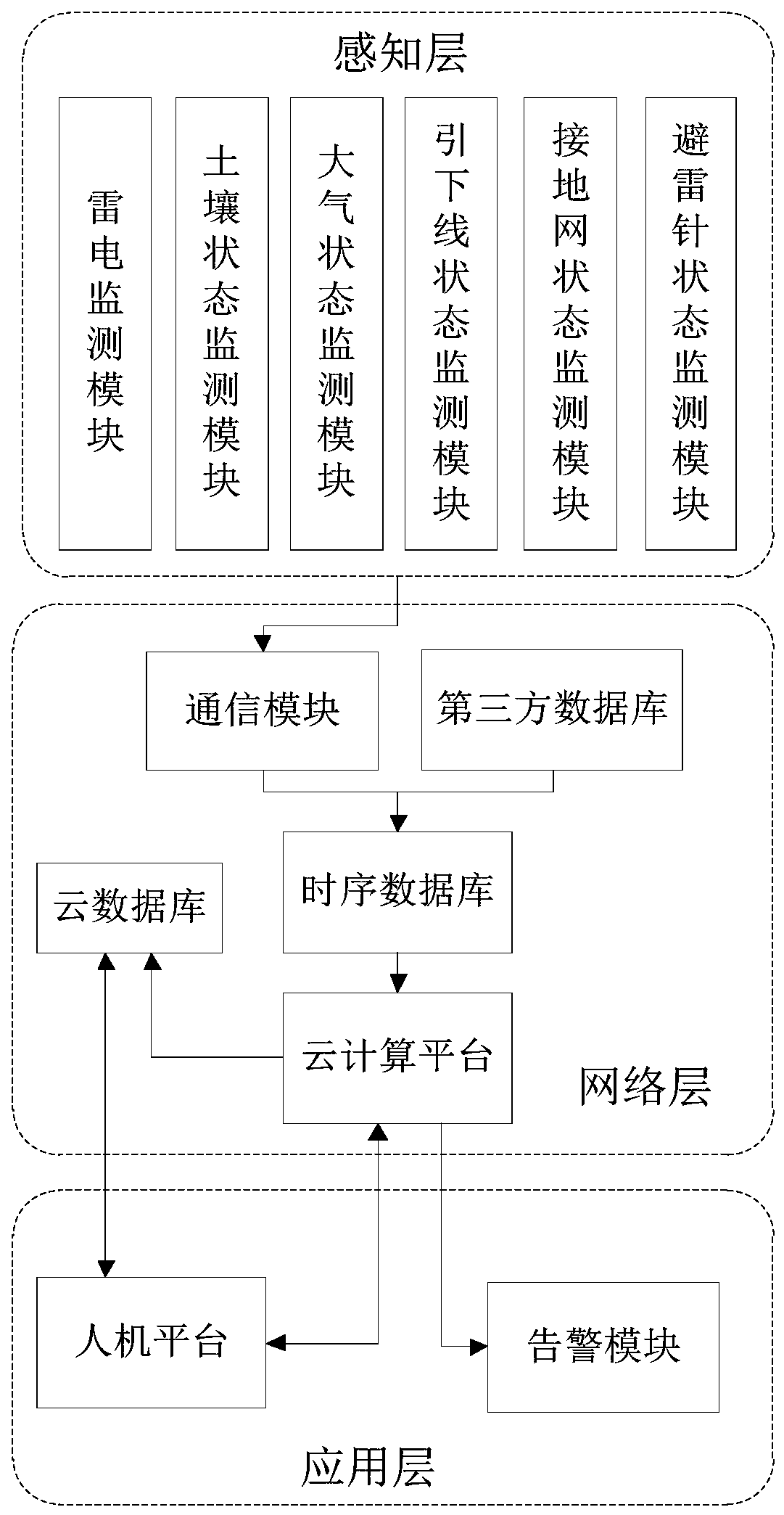

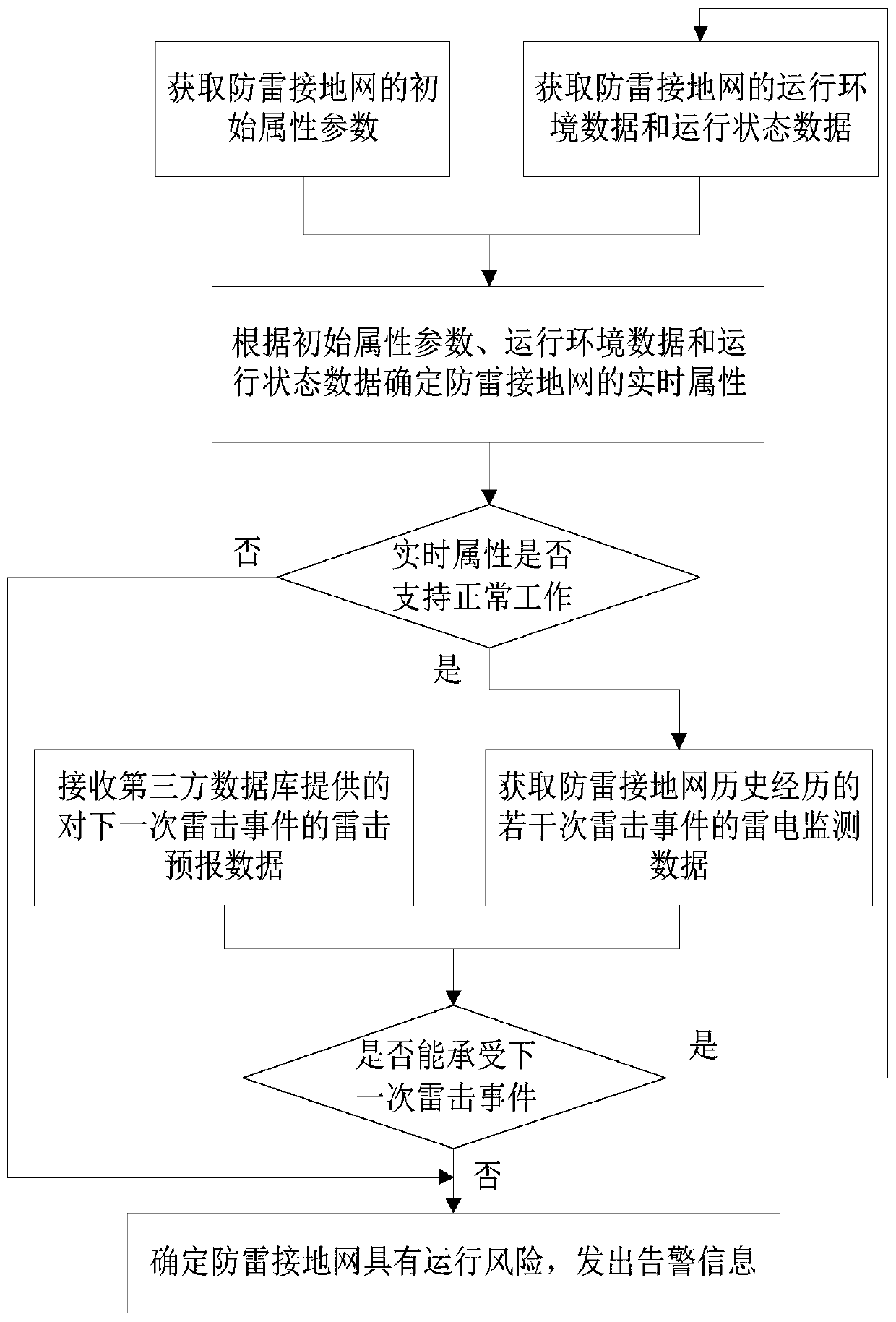

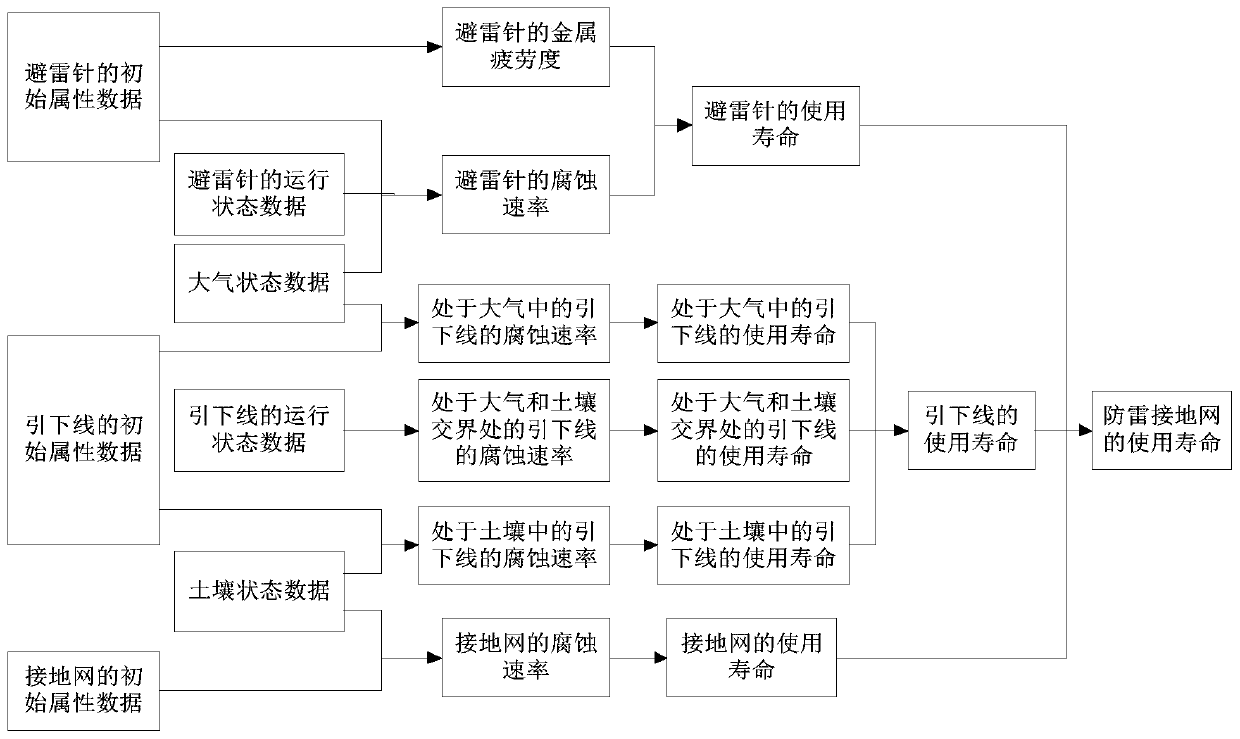

Lightning protection grounding real-time monitoring and risk estimation system and method based on Internet of Things

ActiveCN109784712ARealize real-time monitoringImprove reliabilityMeasurement devicesDatabase management systemsGrounding gridThe Internet

The invention discloses a lightning protection grounding real-time monitoring and risk estimation system and method based on the Internet of Things, and relates to the field of lightning-protection grounding grids. The method is realized based on the Internet of Things. Pass-aware layer, the network layer and the application layer are matched for use; various data of the lightning protection grounding grid can be integrated. According to the lightning protection grounding grid risk prediction method and device, the lightning protection grounding grid can be monitored in real time and the future risk can be predicted by analyzing the logic relation among the data and calculating, analyzing and judging according to the logic relation, the risk can be pre-judged and alarmed in advance, and therefore the monitoring reliability and safety are higher.

Owner:GELIN ELECTRICAL EQUIP PLANT WUXI CITY

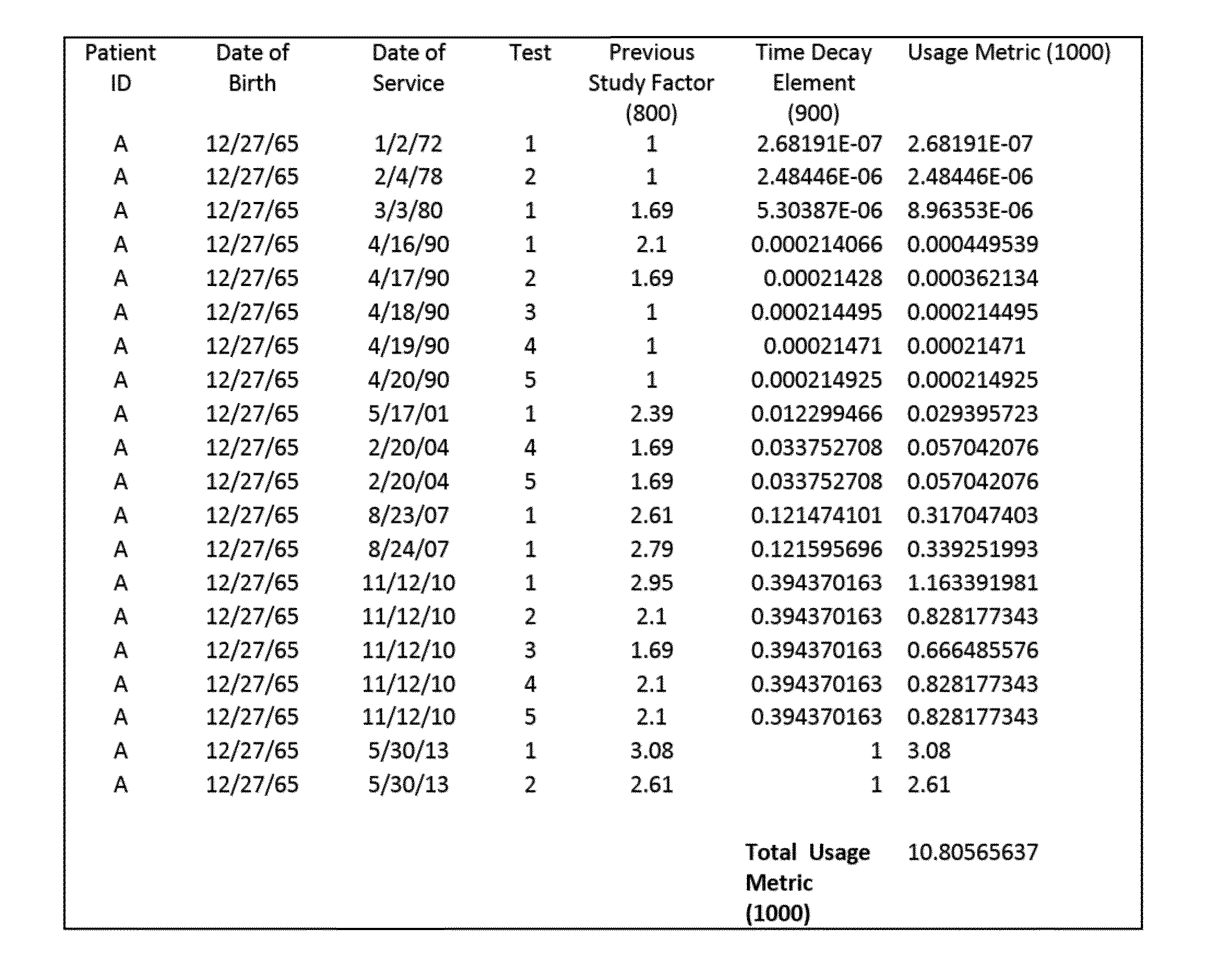

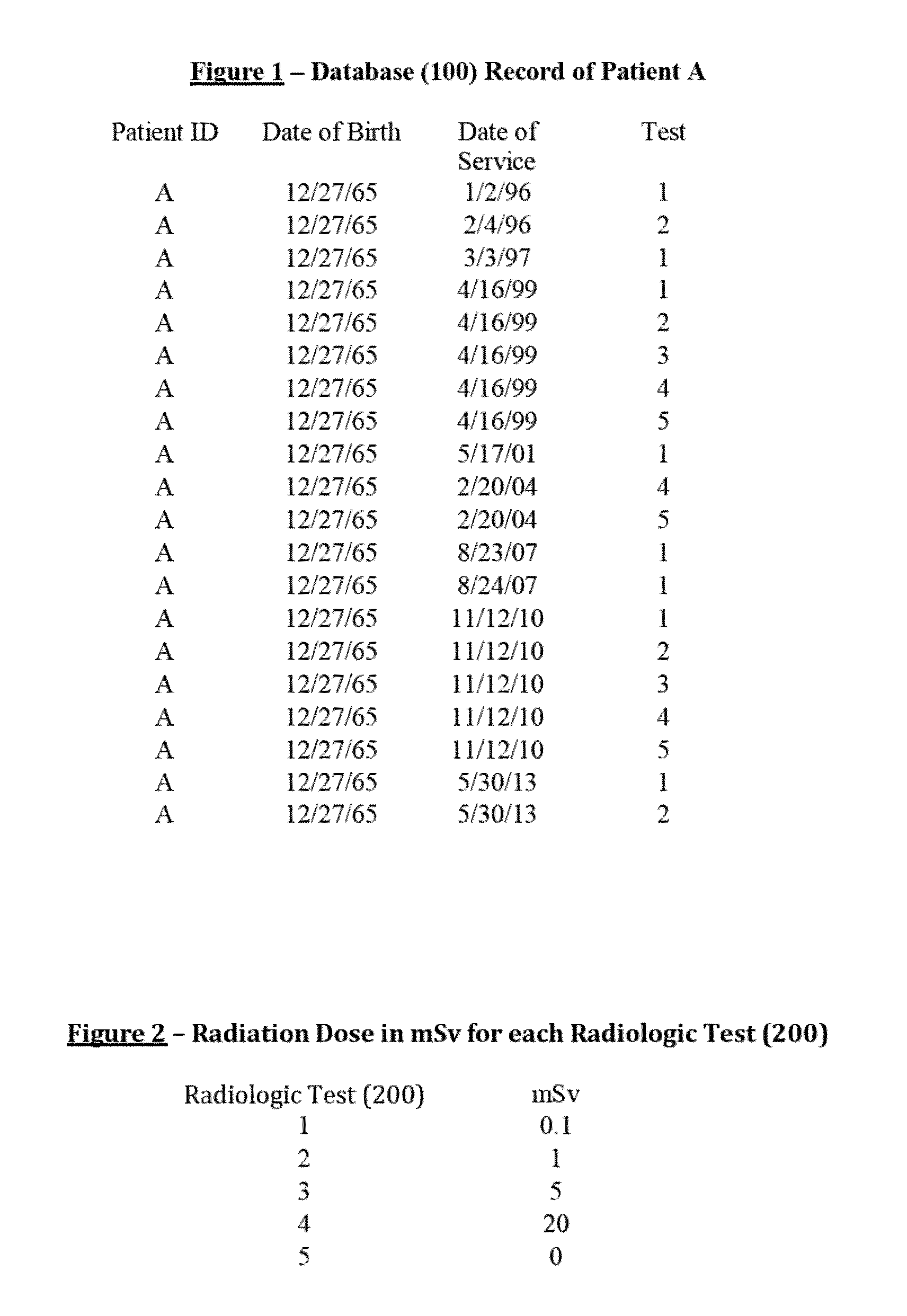

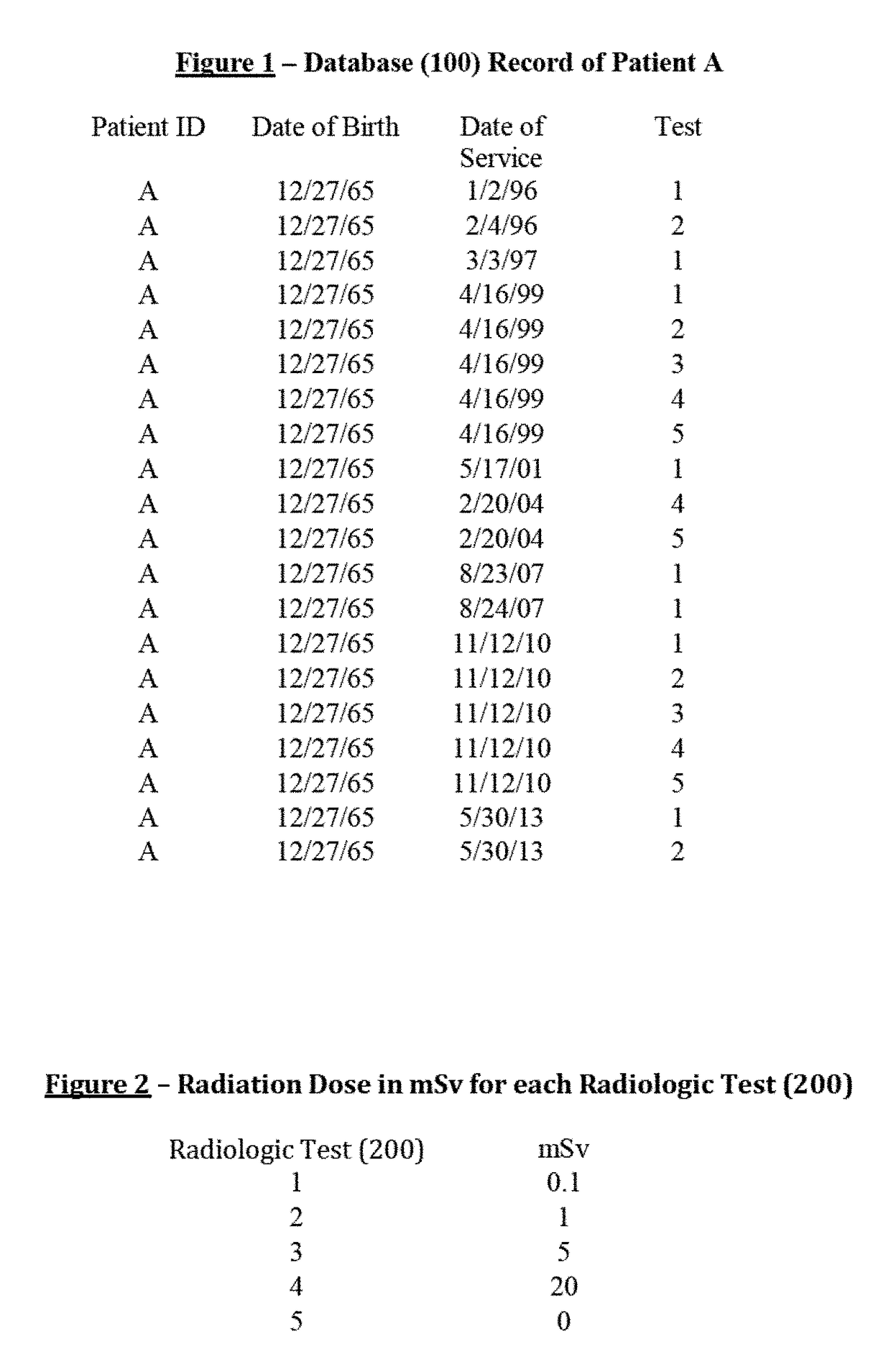

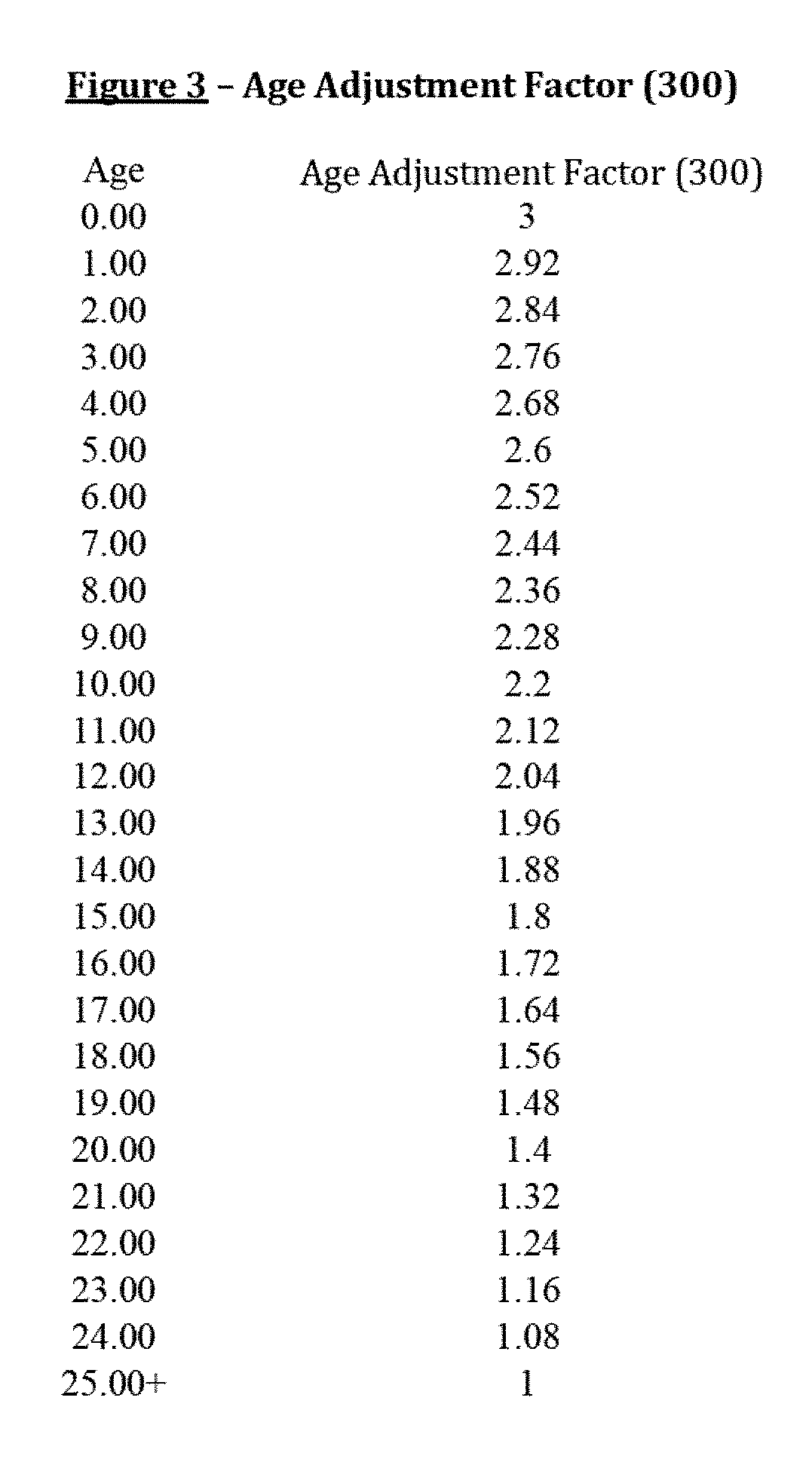

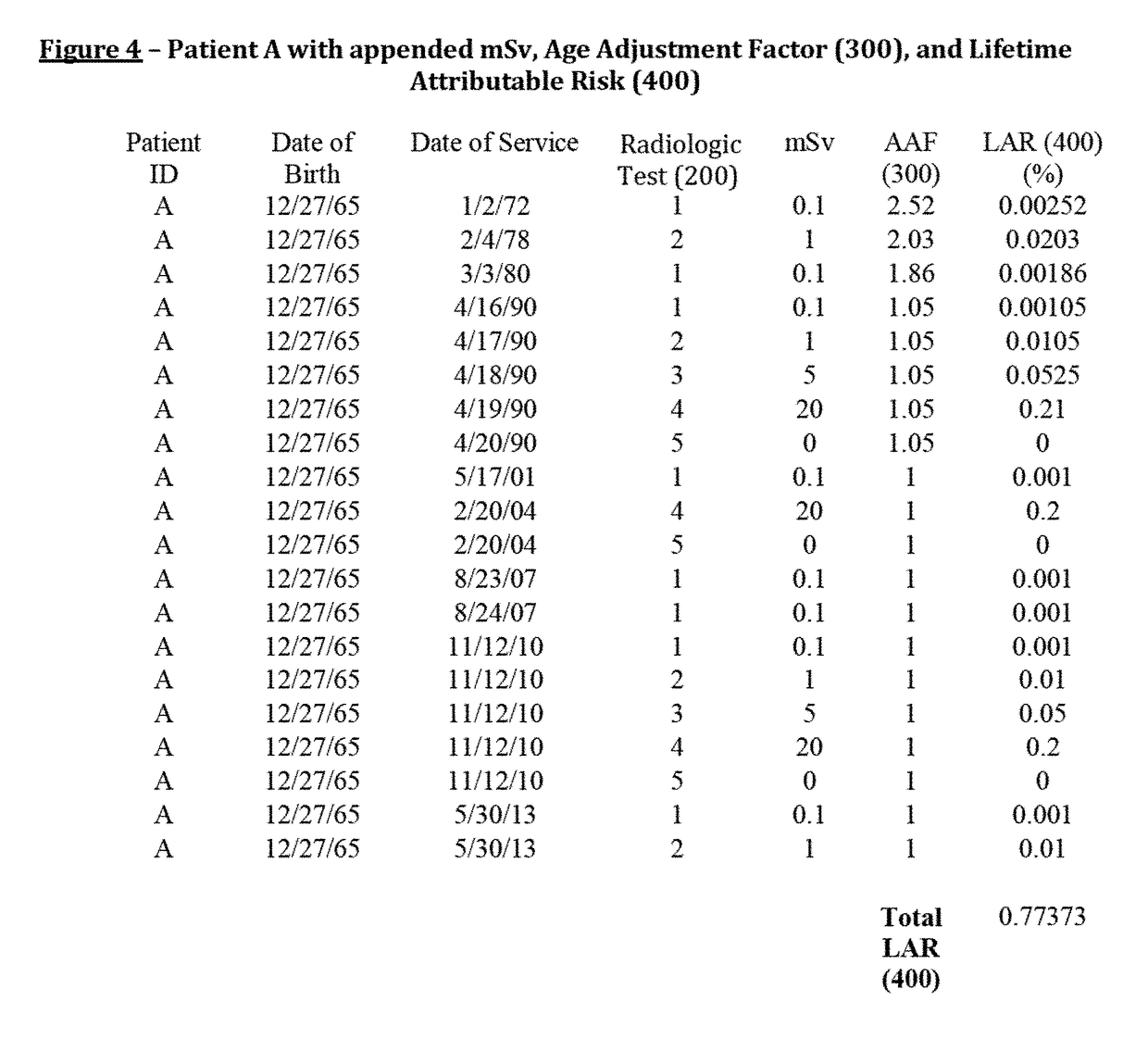

Method, system, and computer program product for determining a patient radiation and diagnostic study score

ActiveUS20150317443A1Reduce usageInherent riskMechanical/radiation/invasive therapiesHealth-index calculationDiagnostic testPresent method

A method for determining a patient radiation and diagnostic study score associated with past diagnostic radiologic tests. In light of the obvious benefits of diagnostic radiology, the risks inherent in its use are often overlooked. Ionizing radiation, which is a component of much, but not all, diagnostic radiology, carries with it a small risk of inducing cancer every time it is used. This additional risk, known as “Lifetime Attributable Risk,” is layered on top of an individual's lifetime base risk of invasive cancer. The present method for determining a patient radiation and diagnostic study score provides right time, right place, and right format radiology information to assist providers in their medical decision-making. With greater awareness of recent study history, and individually contextualized risk and benefit considerations, providers are more likely to decrease their overall usage of diagnostic radiology and better counsel their patients on future risk.

Owner:CLINICENTRIC LLC

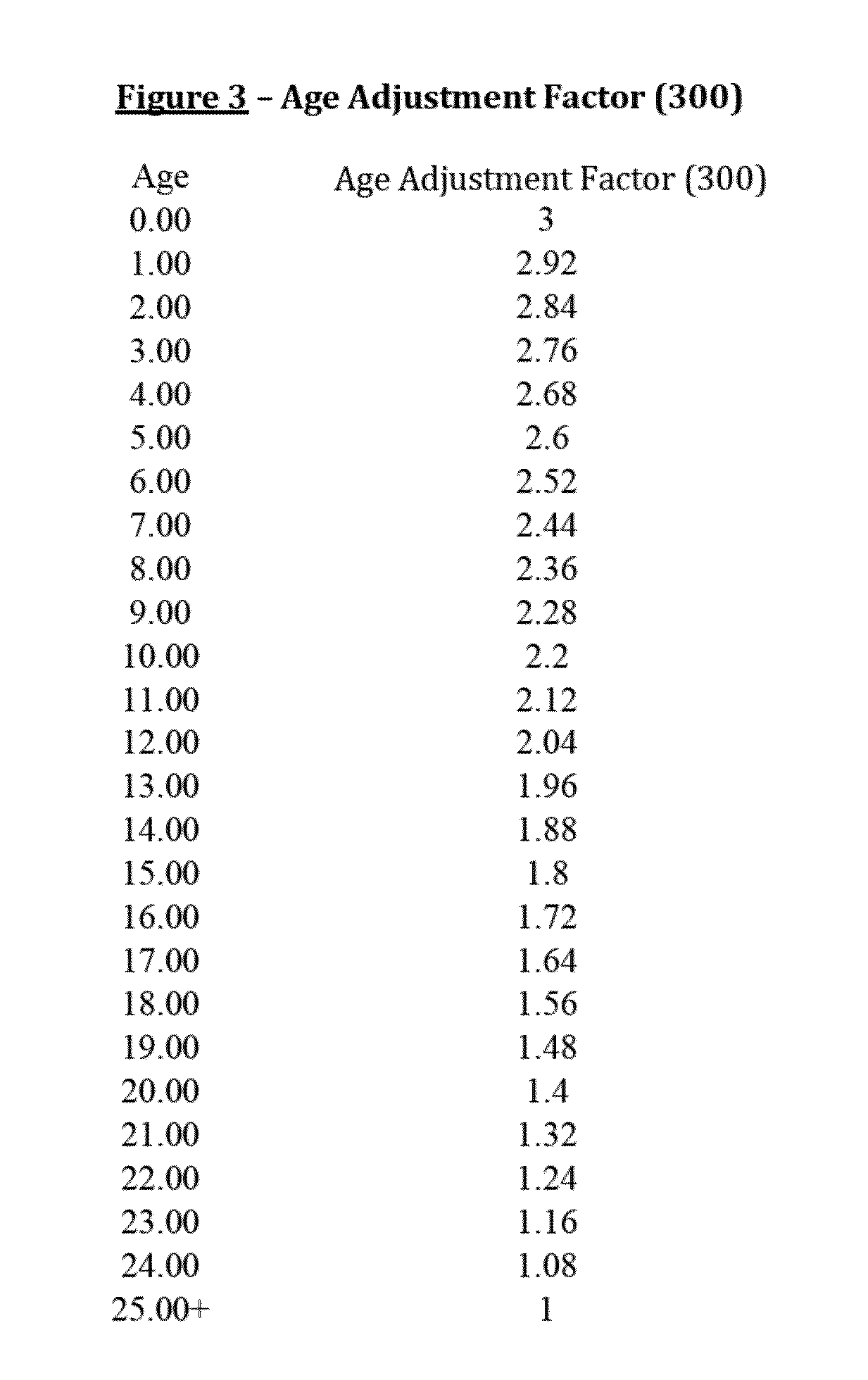

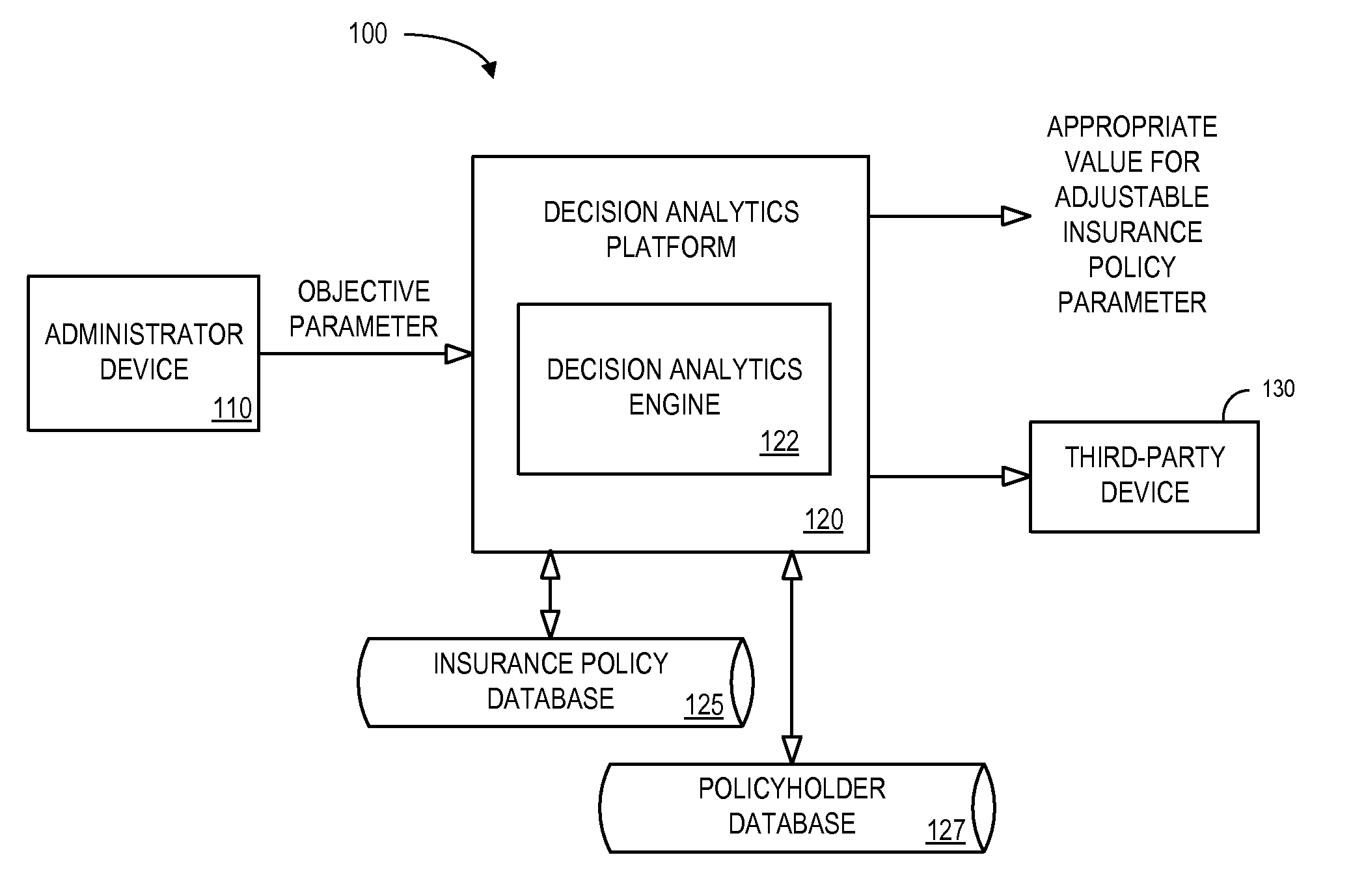

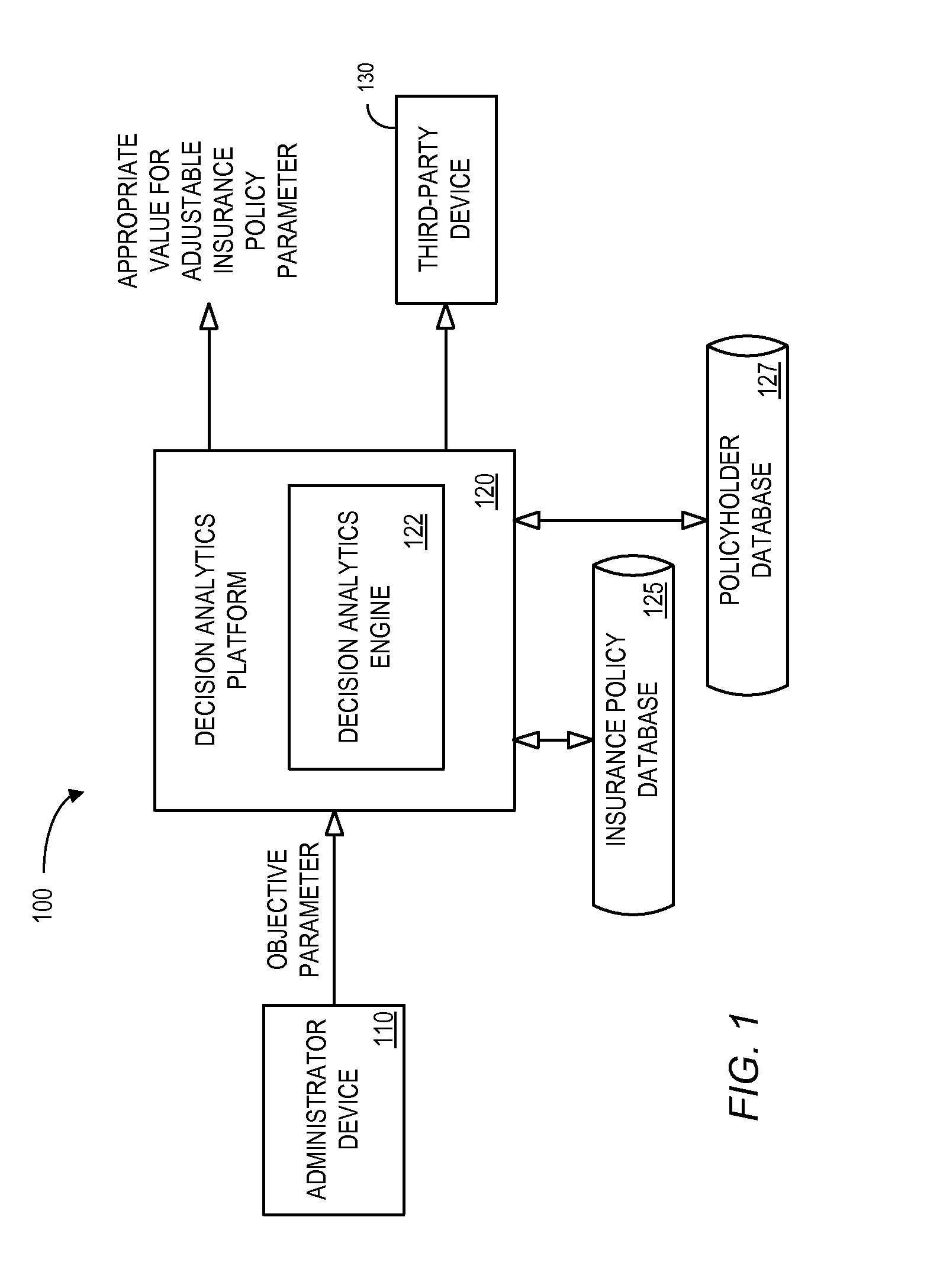

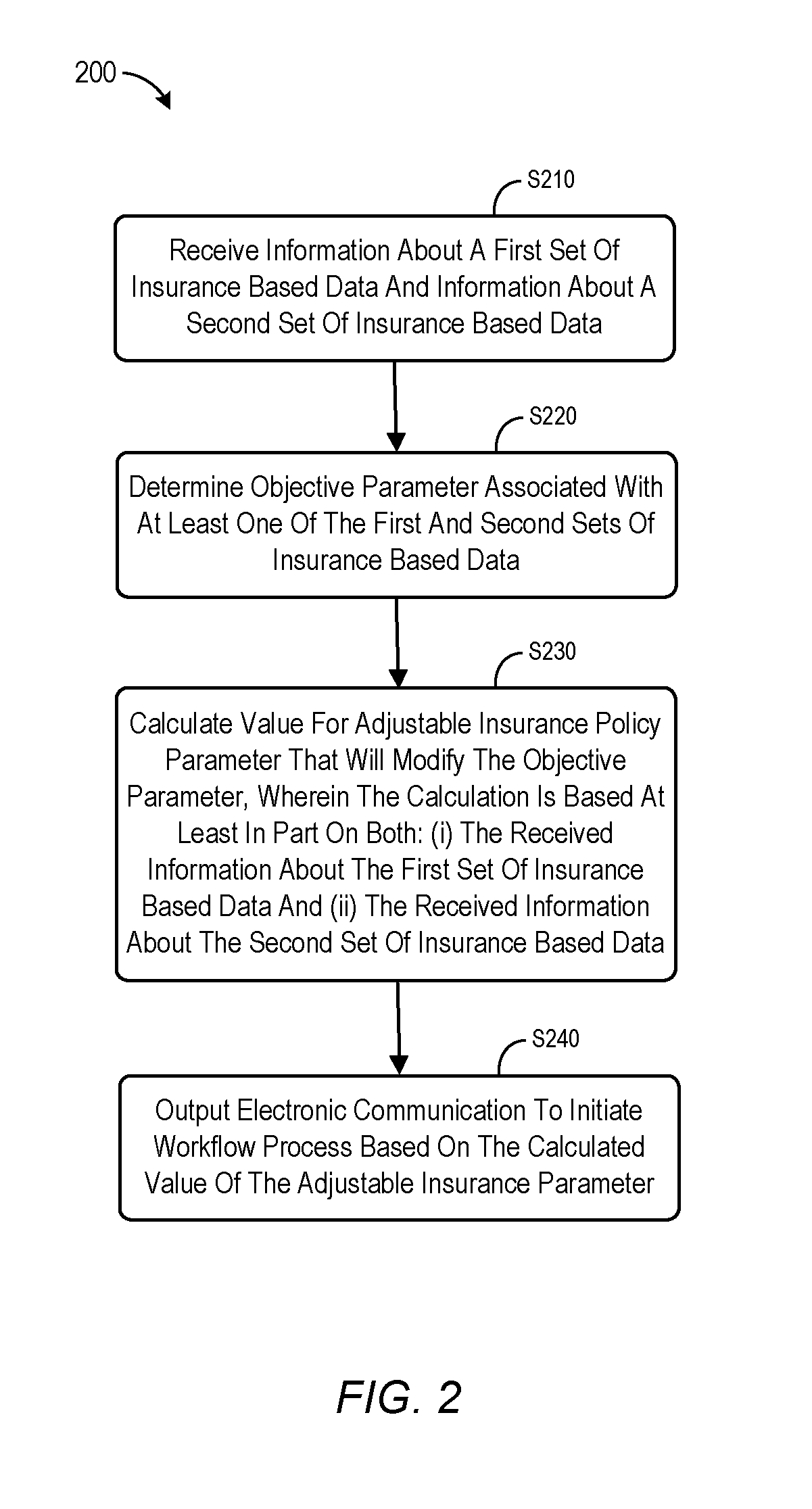

System and method for administering insurance data to mitigate future risks

Owner:HARTFORD FIRE INSURANCE

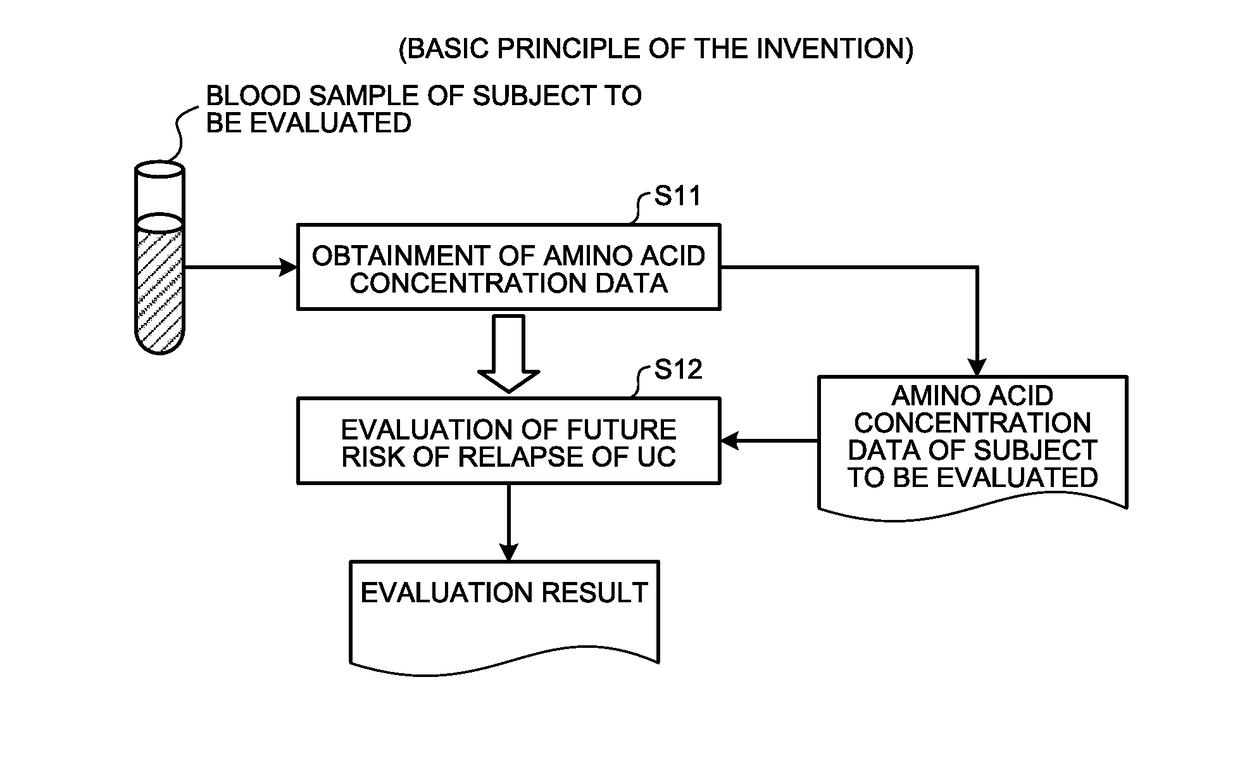

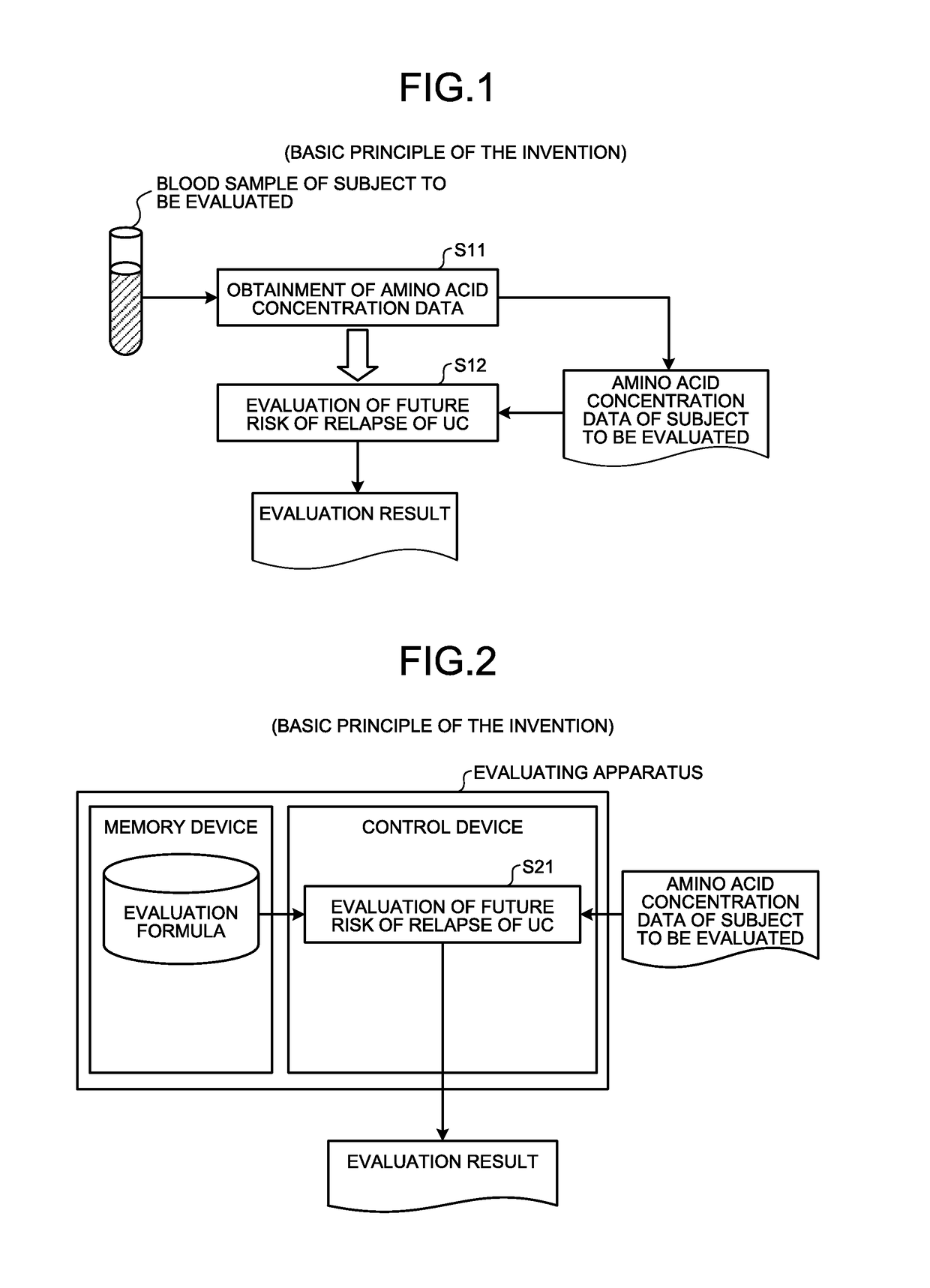

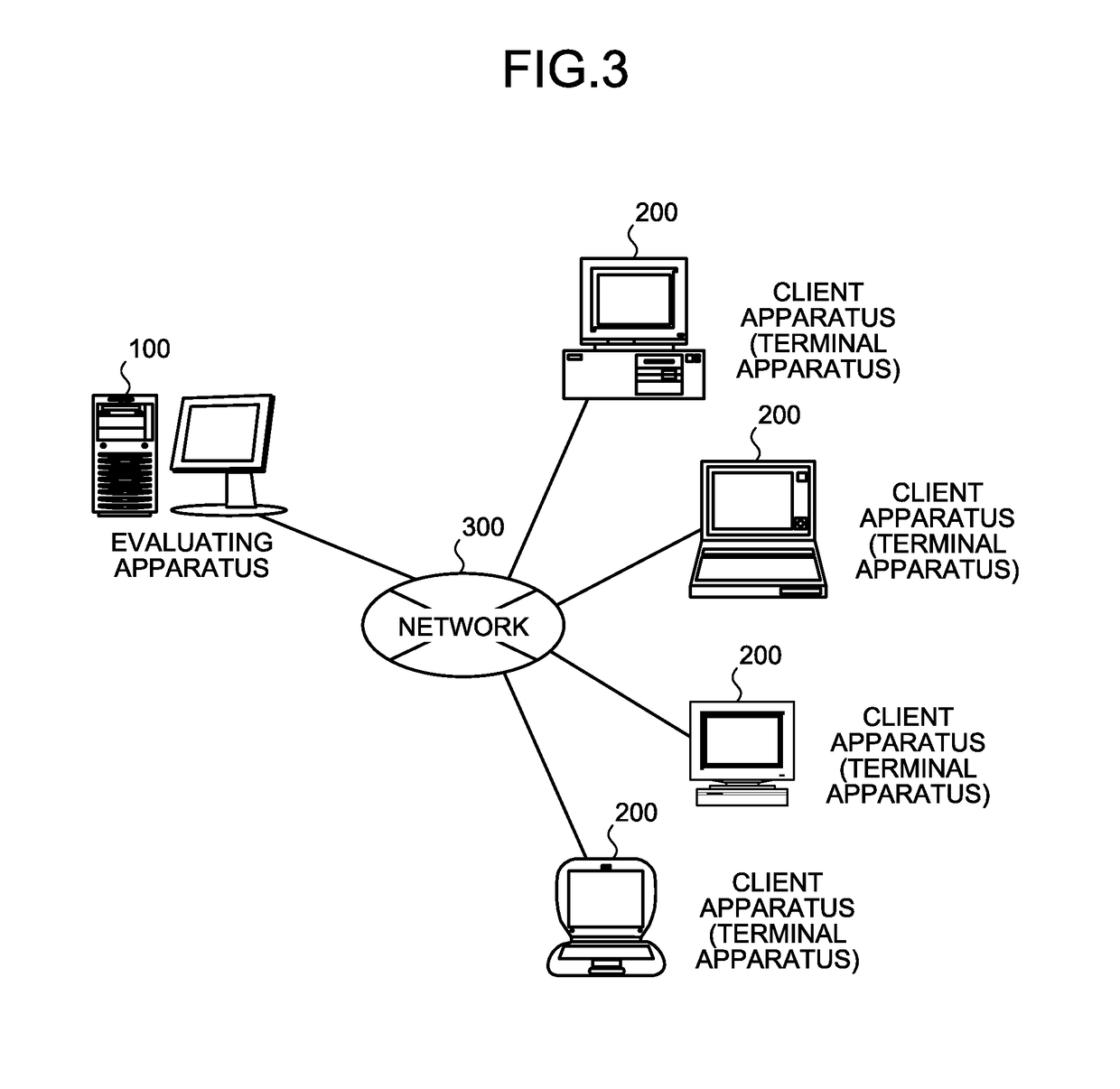

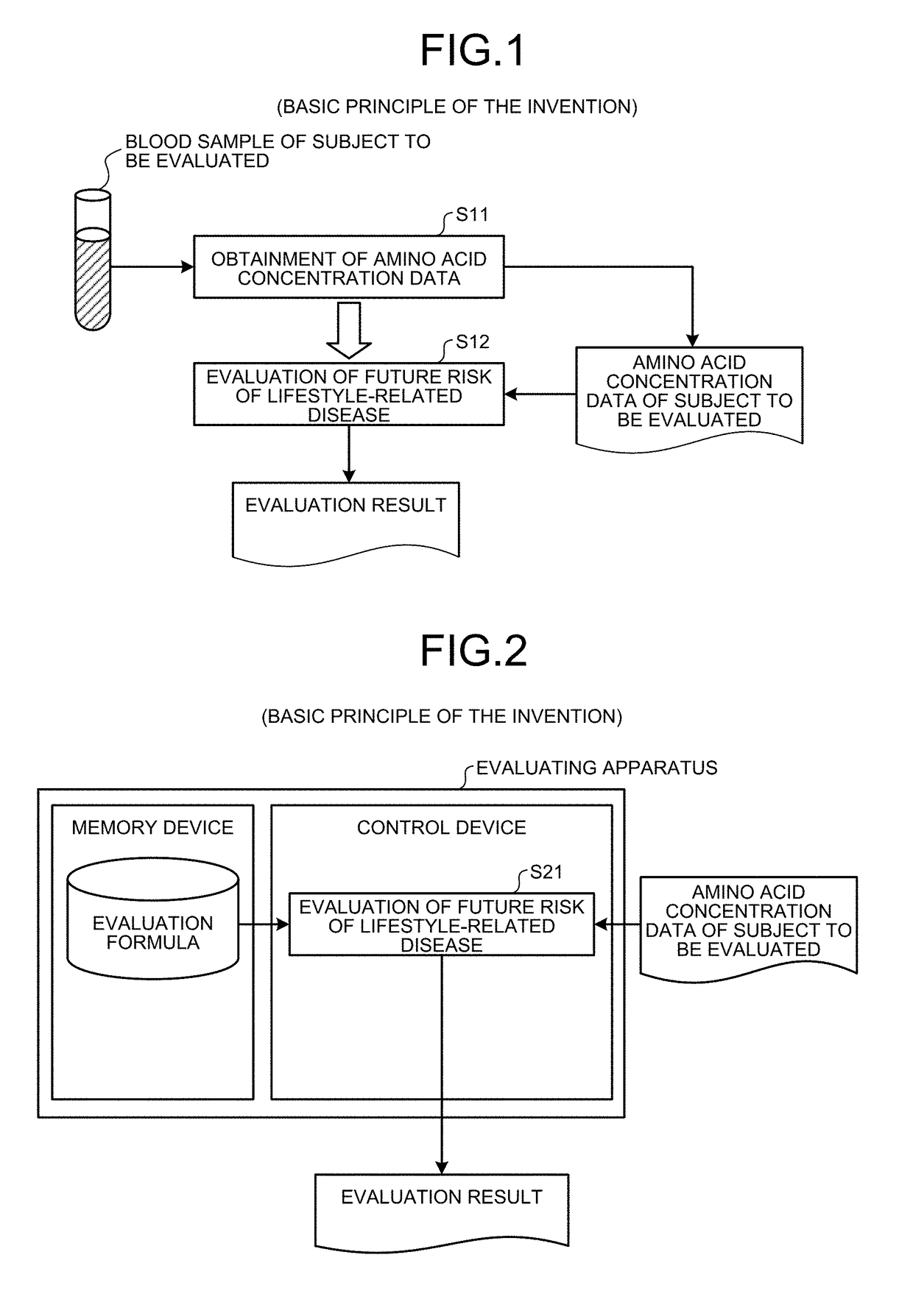

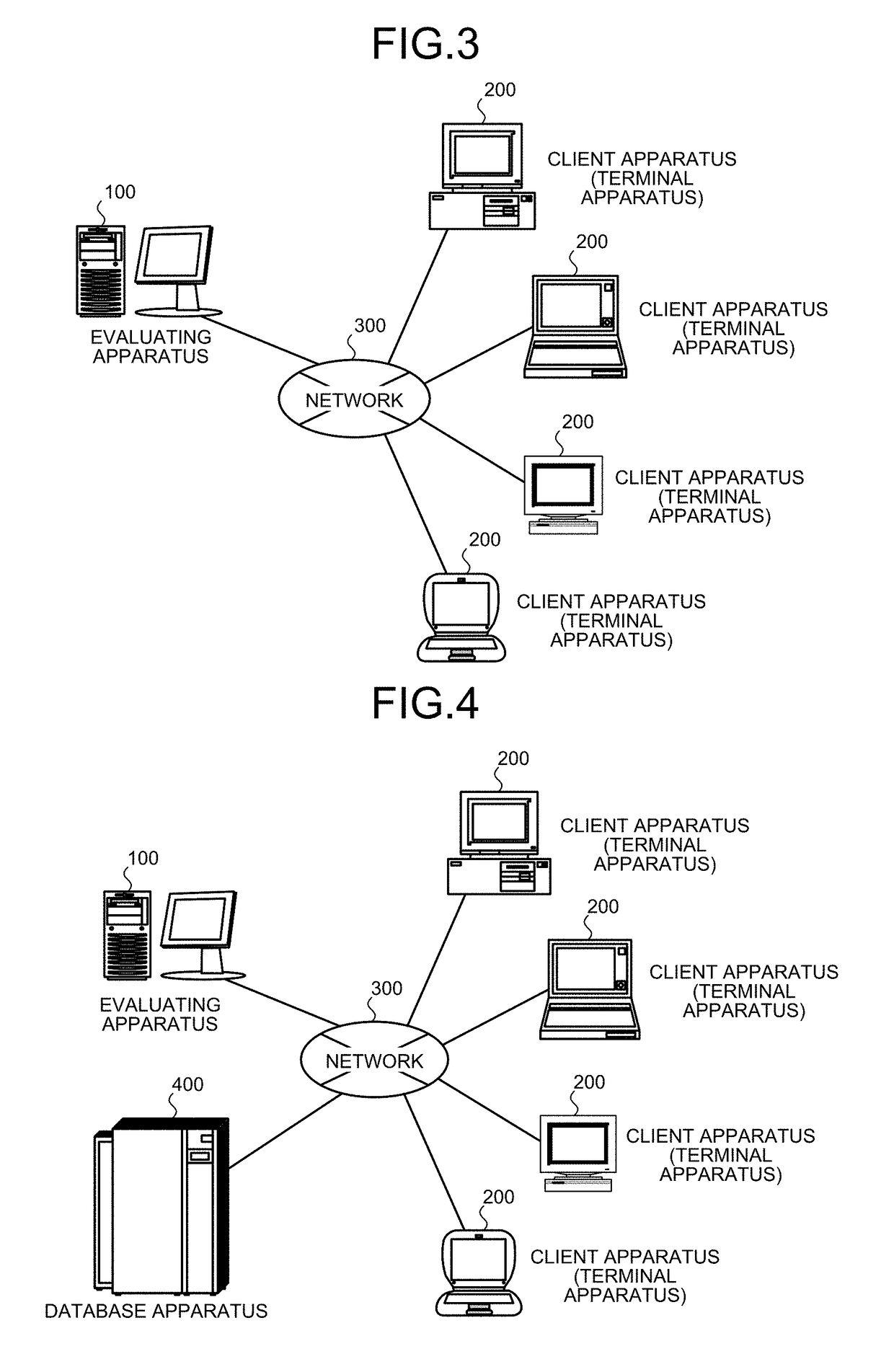

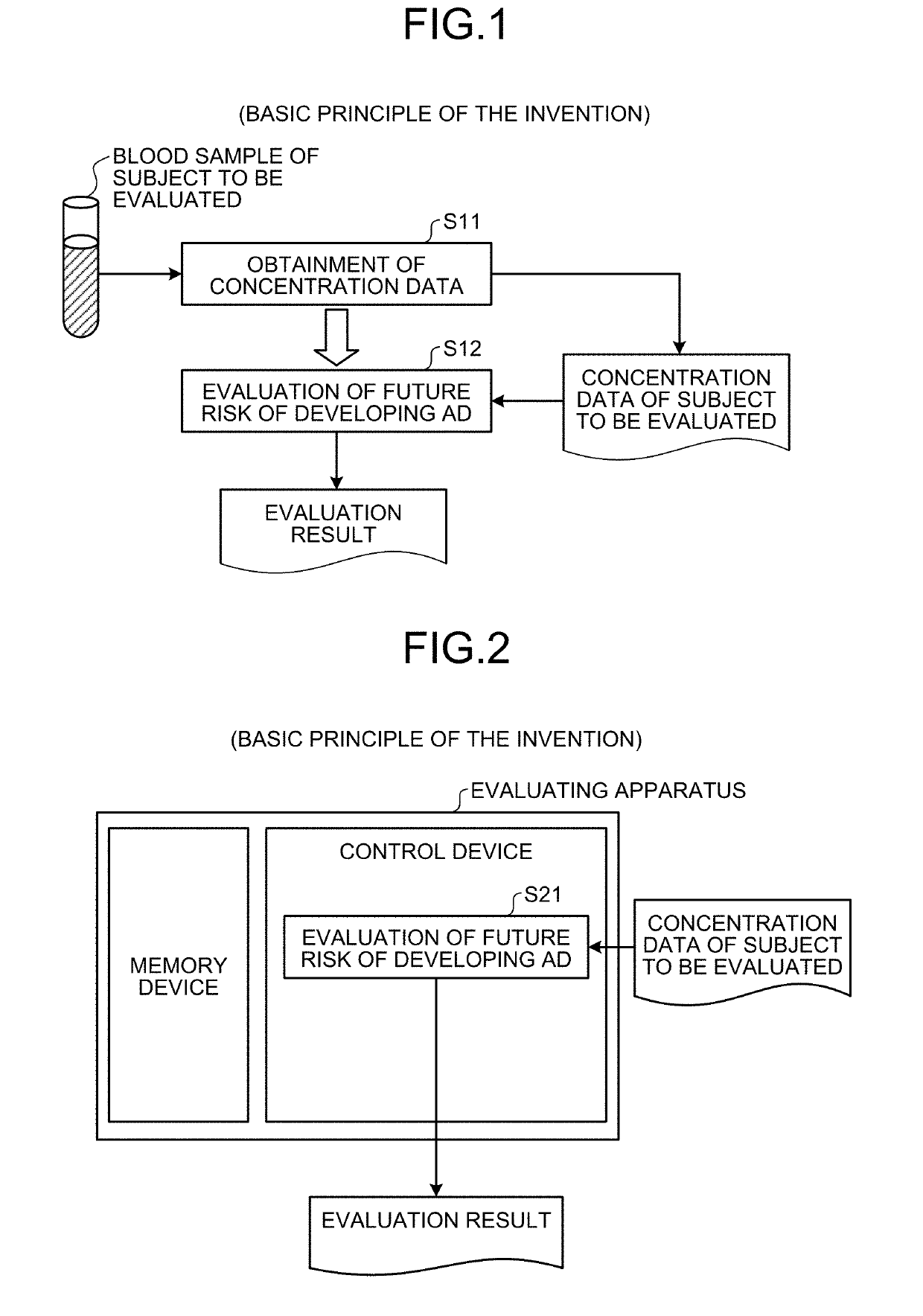

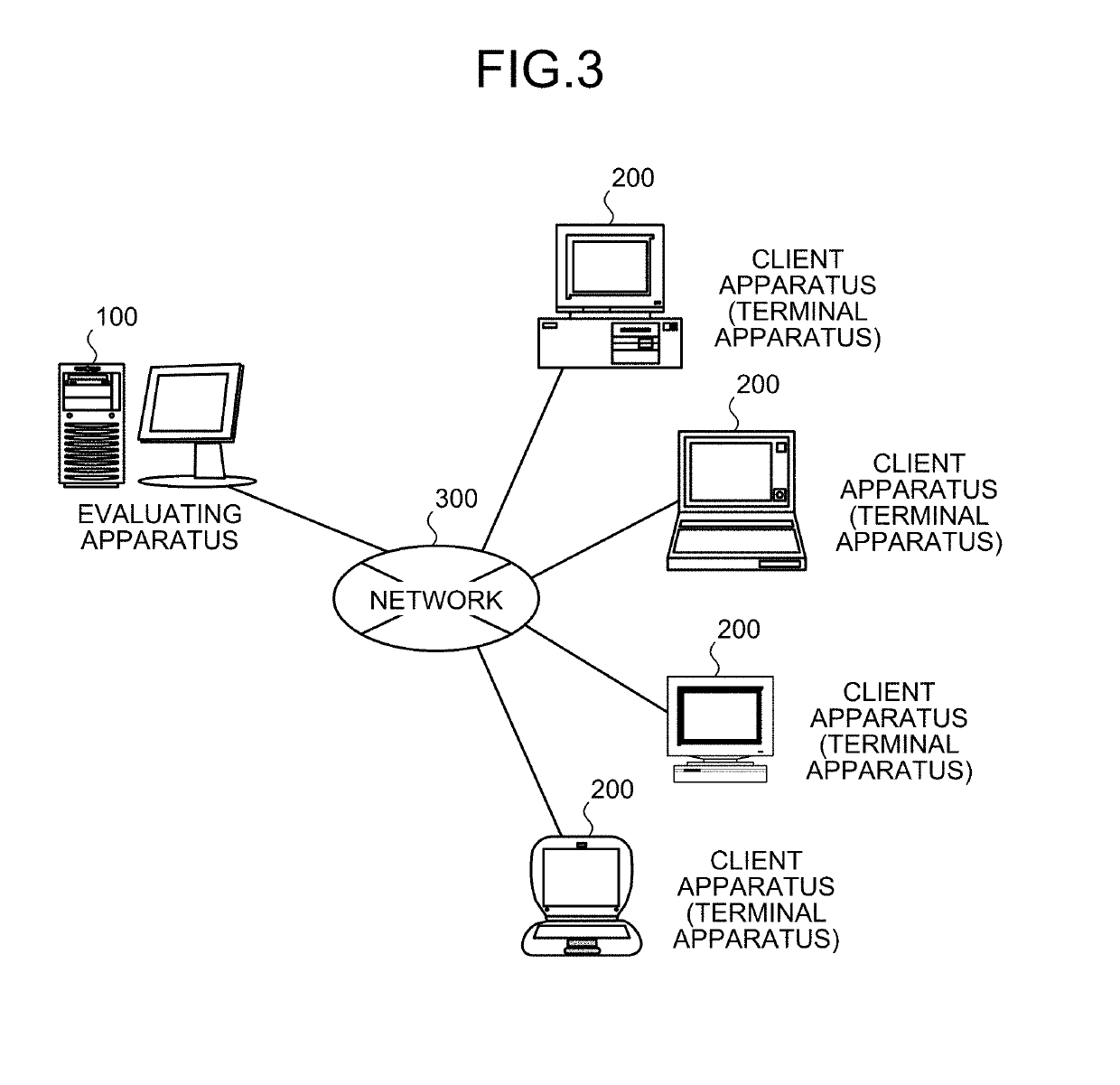

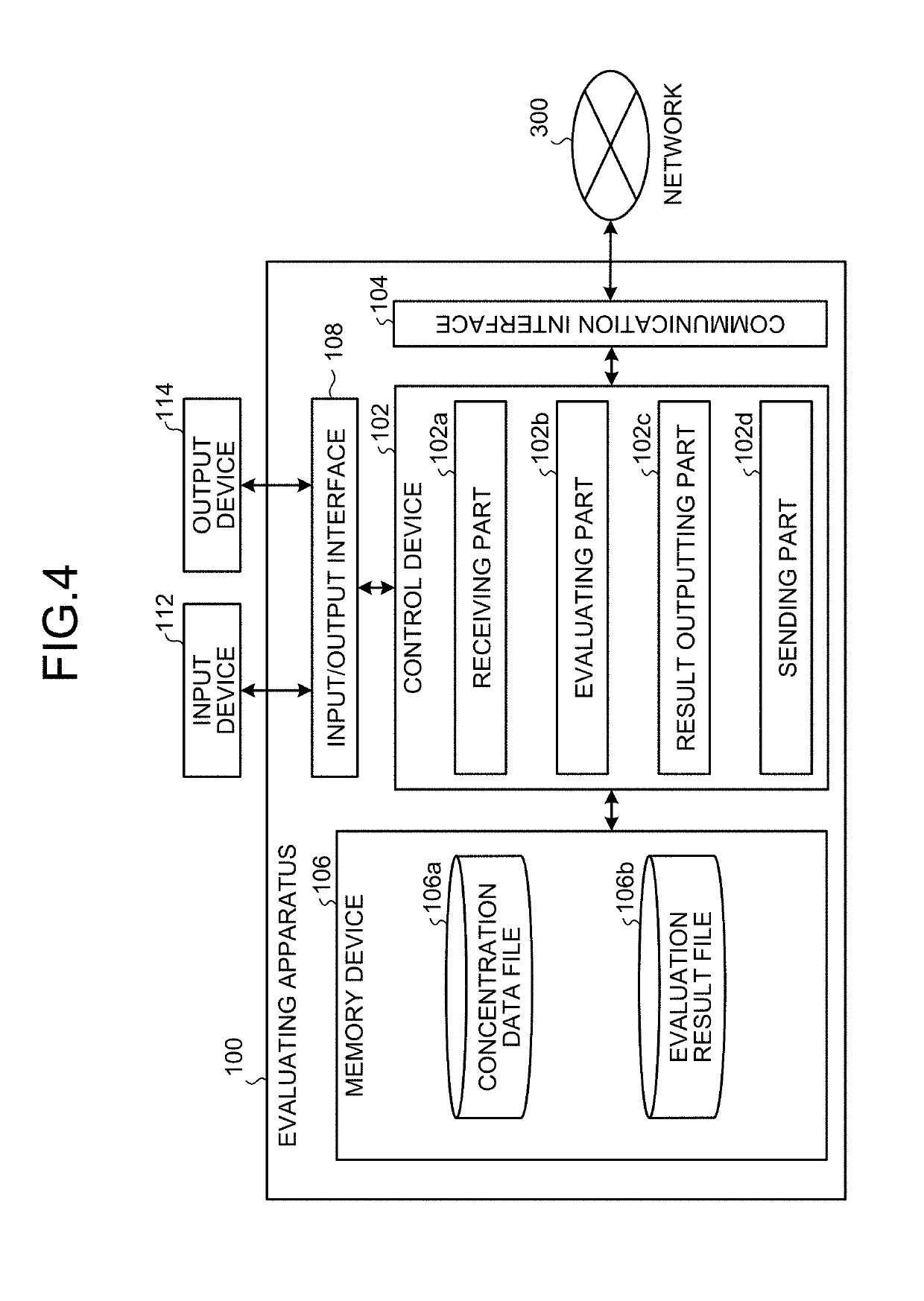

Evaluating method, evaluating apparatus, evaluating program product, evaluating system, and terminal apparatus

InactiveUS20180017545A1Risk of relapseReliable informationError preventionHealth-index calculationMedicineUlcerative colitis

An evaluating method includes an evaluating step of evaluating a future risk of relapse of ulcerative colitis for a subject to be evaluated having ulcerative colitis in a remission phase using a concentration value of histidine, albumin, hemoglobin, or glutamic acid in blood of the subject.

Owner:AJINOMOTO CO INC

Stock fluctuation prediction method

The present invention belongs to the information processing technical field and relates to a stock fluctuation prediction method. The method includes the following steps that: step 1, original data are read from a database, wherein the original data include stock-related market data and financial statement data; step 2, a fluctuation prediction model is established; and step 3, the model established in the step 2 is used to calculate individual stock return fluctuation. According to the stock fluctuation prediction method of the present invention, the future risk of investment portfolios can be predicted based on the predictability of the model, so that investors can be facilitated to do the better beforehand risk management; by means of different factor decomposition, risks can be predicted and quantified, and the stability of the prediction of the risks can be improved; and investment risks can be decomposed according to different sources, and therefore, so that the investors can choose risks which they want to take and risks which they want to avoid in a more targeted manner.

Owner:四川倍发科技有限公司

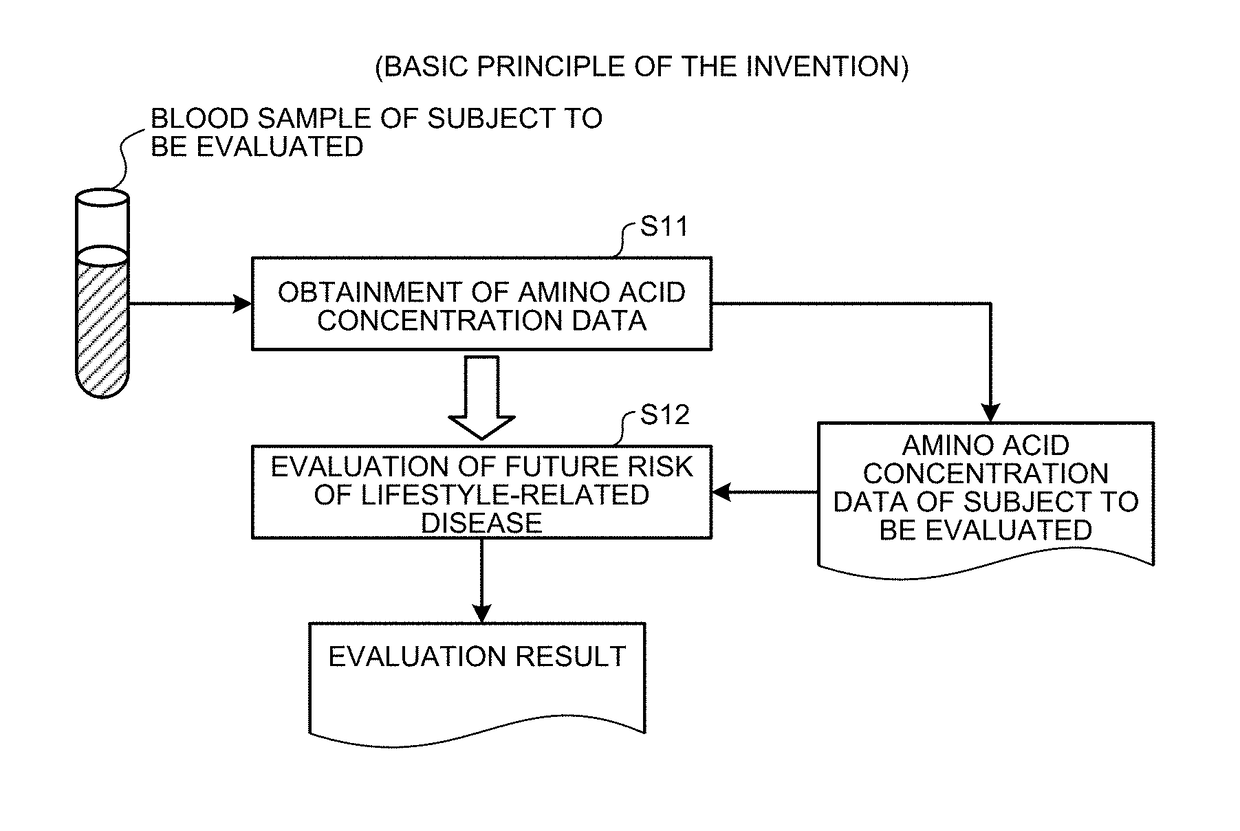

Evaluating method, evaluating apparatus, evaluating program product, evaluating system, and terminal apparatus

An evaluating method includes an evaluating step of evaluating a future risk of lifestyle-related disease for a subject to be evaluated using a concentration value of an amino acid included in amino acid concentration data on the concentration value of the amino acid in blood collected from the subject.

Owner:AJINOMOTO CO INC

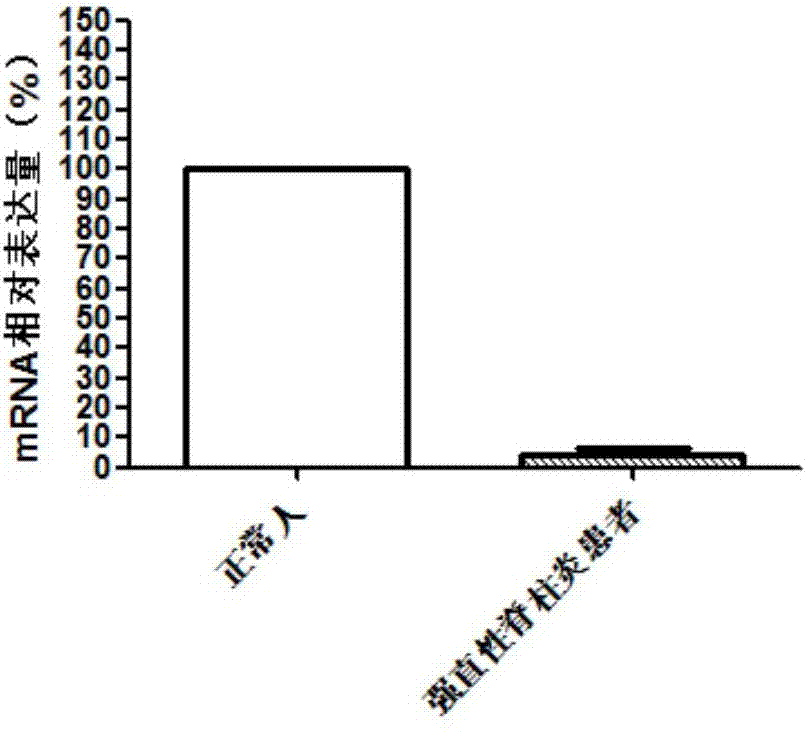

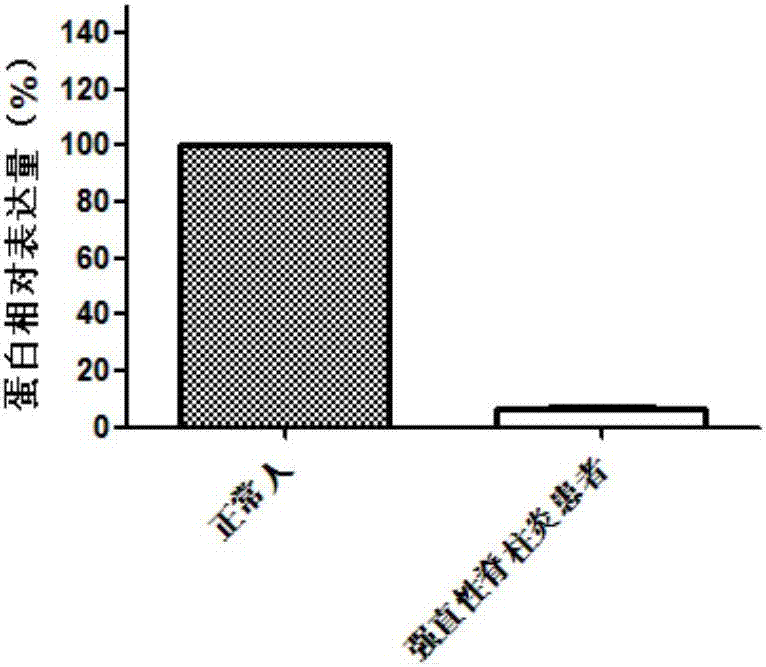

Application of KLHL22 gene and expression product thereof to preparation of diagnostic product

InactiveCN107012254AMicrobiological testing/measurementDisease diagnosisAnkylosing spondylitisExpression gene

The invention discloses the application of KLHL22 gene and its expression product in preparing diagnostic products. This diagnostic product can be used for the diagnosis of ankylosing spondylitis. By detecting the level of the KLHL22 gene and its expression products, the risk of the subject suffering from ankylosing spondylitis in the future or the status of ankylosing spondylitis can be determined. The diagnostic product of the present invention takes the peripheral blood of the subject as the detection object, and can realize non-invasive, rapid, sensitive and accurate diagnostic effects.

Owner:BEIJING MEDINTELL BIOMED CO LTD

Evaluating method for future risk of developing alzheimer's disease

An evaluating method includes an evaluating step of evaluating future risk of developing Alzheimer's disease for a subject to be evaluated having mild cognitive impairment using a concentration value of at least one of α-ABA, Ala, Arg, Asn, Cit, Gln, Glu, Gly, His, Ile, Leu, Lys, Met, Orn, Phe, Pro, Ser, Thr, Trp, Tyr, Val, Cysteine, Taurine, bABA, Ethylglycine, Hypotaurine, 3-Me-His, 5-HydroxyTrp, aAiBA, and N8-Acetylspermidine in blood of the subject.

Owner:AJINOMOTO CO INC

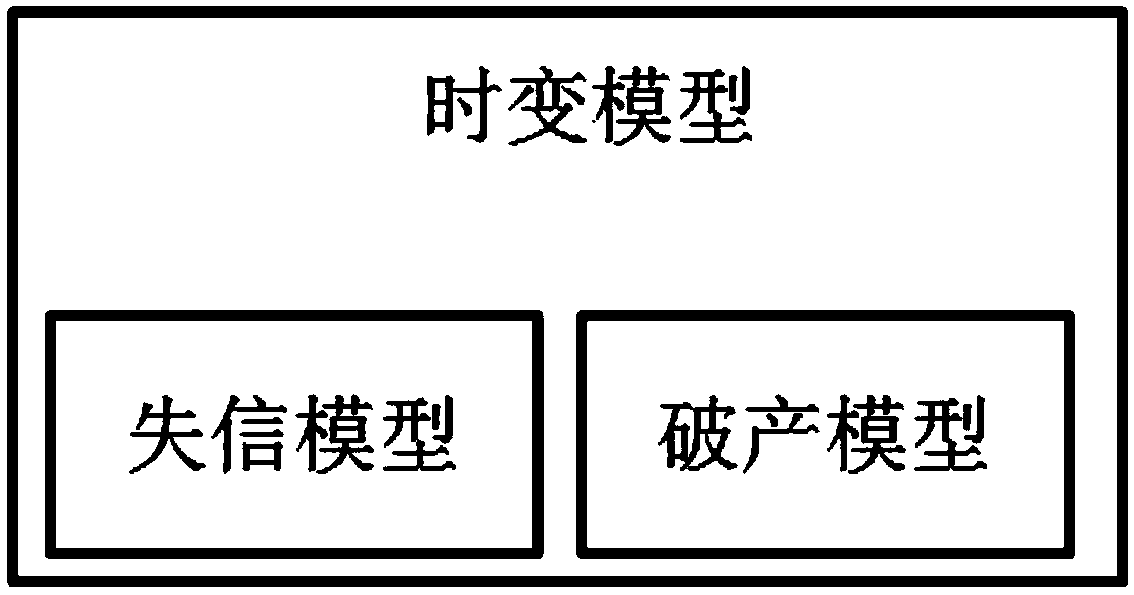

An enterprise risk time-varying model based on Cox regression prediction

The invention discloses an enterprise risk time-varying model based on Cox regression prediction. The model comprises a production breaking model and a credit losing model. The construction method ofthe production-breaking / credit-losing model comprises the following steps of S1, determining a production breaking / credit losing model feature X; S2, formulating a production breaking / credit losing model to observe the initial time; S3, setting broken production / untrusted observation time; S4, setting a production-breaking / credit-losing end point time; S5, setting a production-breaking / credit-losing survival time; S6, determining a reference risk function h0 (T) of the production-breaking / credit-losing model; S7, determining a partial regression coefficient beta of the characteristic X of thebreaking / losing model through likelihood estimation; S8, setting the survival time T, a production breaking / credit losing model feature X, a reference risk function of a production / credit loss model;substituting the partial regression coefficients beta of the characteristics of the production / failure model into a risk function formula of the Cox proportional regression model. According to the model disclosed by the invention, the future risk change trend of an enterprise can be predicted, so that the possibility of enterprise risk occurrence can be predicted.

Owner:重庆誉存科技有限公司

Method, system, and computer program product for determining a patient radiation and diagnostic study score

ActiveUS9974512B2Reduce usageInherent riskMechanical/radiation/invasive therapiesHealth-index calculationPresent methodAttributable risk

Owner:CLINICENTRIC LLC

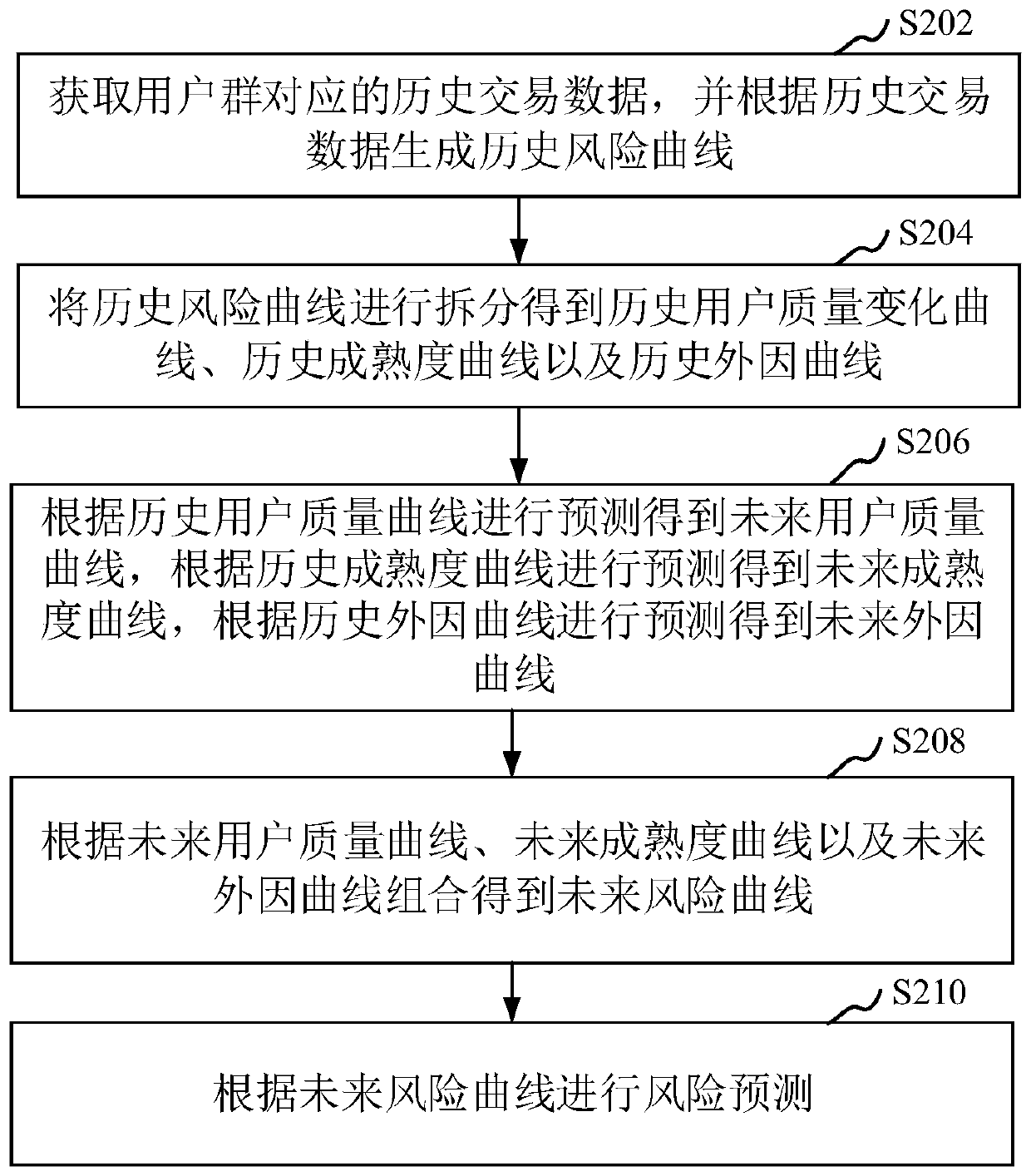

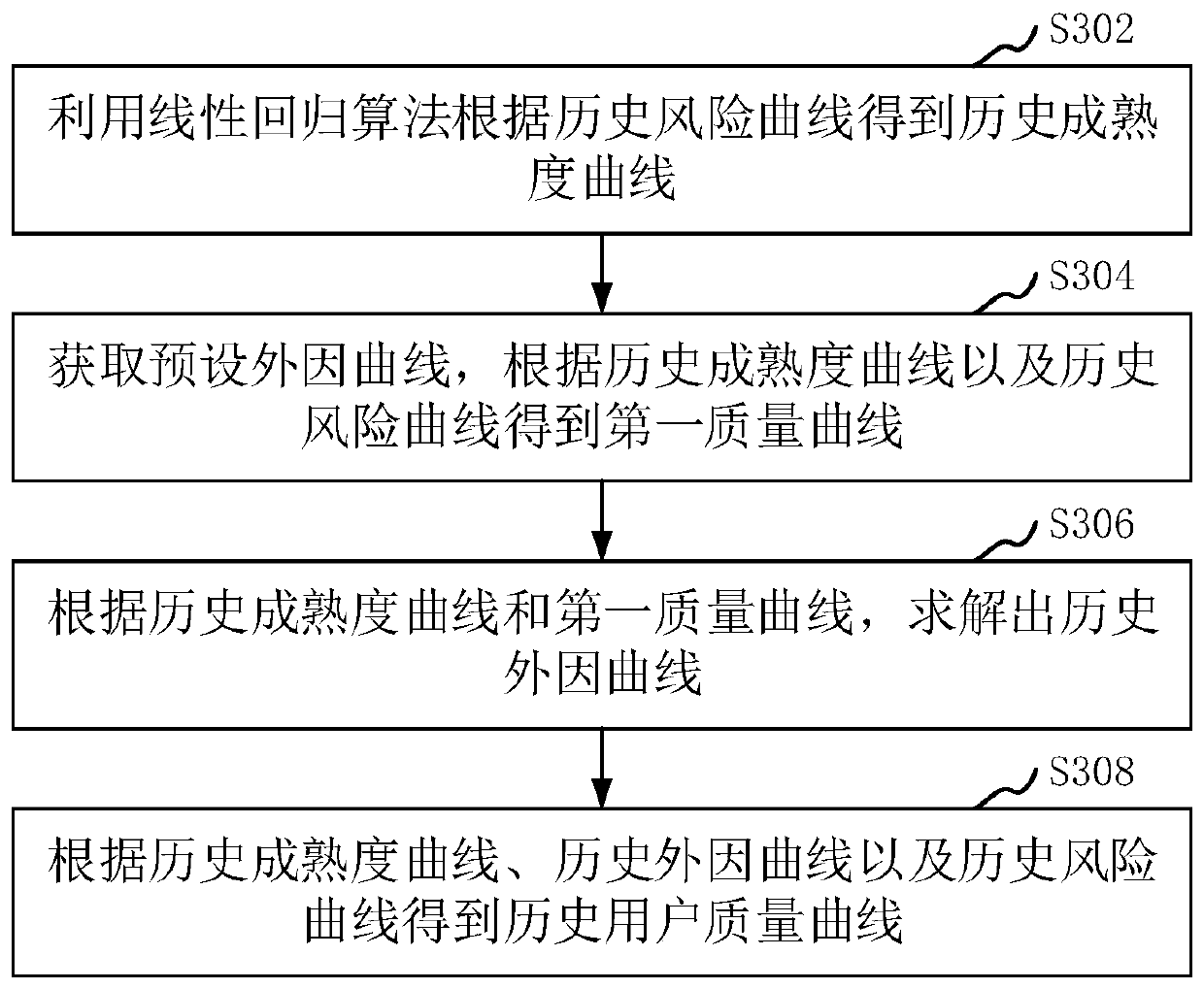

Risk prediction method and device, computer equipment and storage medium

PendingCN110110882APredict risk fluctuation data is accurateFinanceForecastingRisk curvesTransaction data

The invention relates to the field of big data analysis, in particular to a risk prediction method and device, computer equipment and a storage medium. The method comprises the steps of obtaining historical transaction data corresponding to a user group, and generating a historical risk curve according to the historical transaction data; splitting the historical risk curve to obtain a historical user quality change curve, a historical maturity curve and a historical exogenous curve; predicting according to the historical user quality curve to obtain a future user quality curve, predicting according to the historical maturity curve to obtain a future maturity curve, and predicting according to the historical external cause curve to obtain a future external cause curve; obtaining a future risk curve according to the future user quality curve, the future maturity curve and the future external cause curve combination; and performing risk prediction according to the future risk curve. By adopting the method, the obtained predicted risk fluctuation data of the user group can be more accurate.

Owner:平安直通咨询有限公司

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com