Patents

Literature

131 results about "IT risk management" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

IT risk management is the application of risk management methods to information technology in order to manage IT risk, i.e.: The business risk associated with the use, ownership, operation, involvement, influence and adoption of IT within an enterprise or organization IT risk management can be considered a component of a wider enterprise risk management system. The establishment, maintenance and continuous update of an Information security management system (ISMS) provide a strong indication that a company is using a systematic approach for the identification, assessment and management of information security risks.

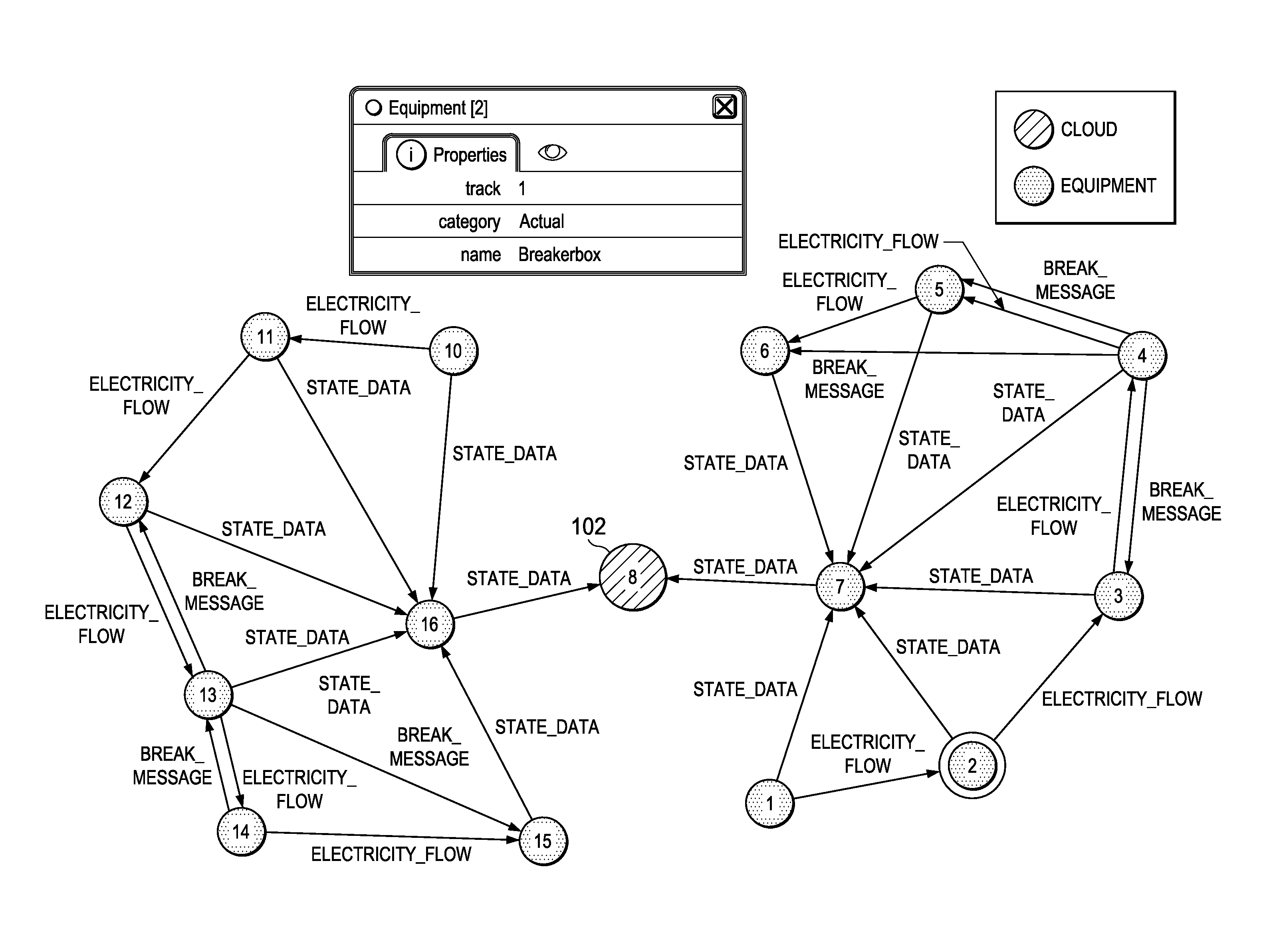

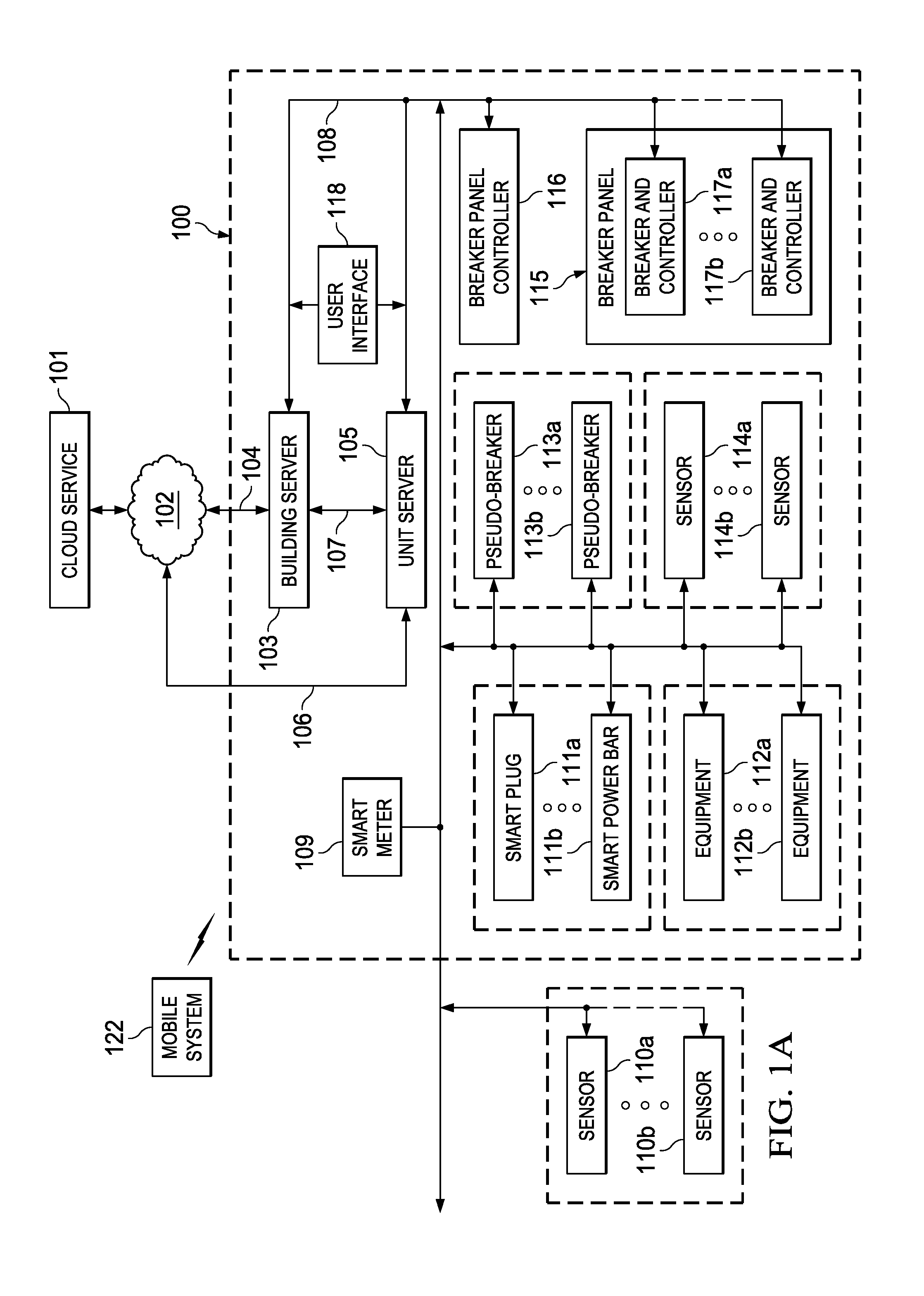

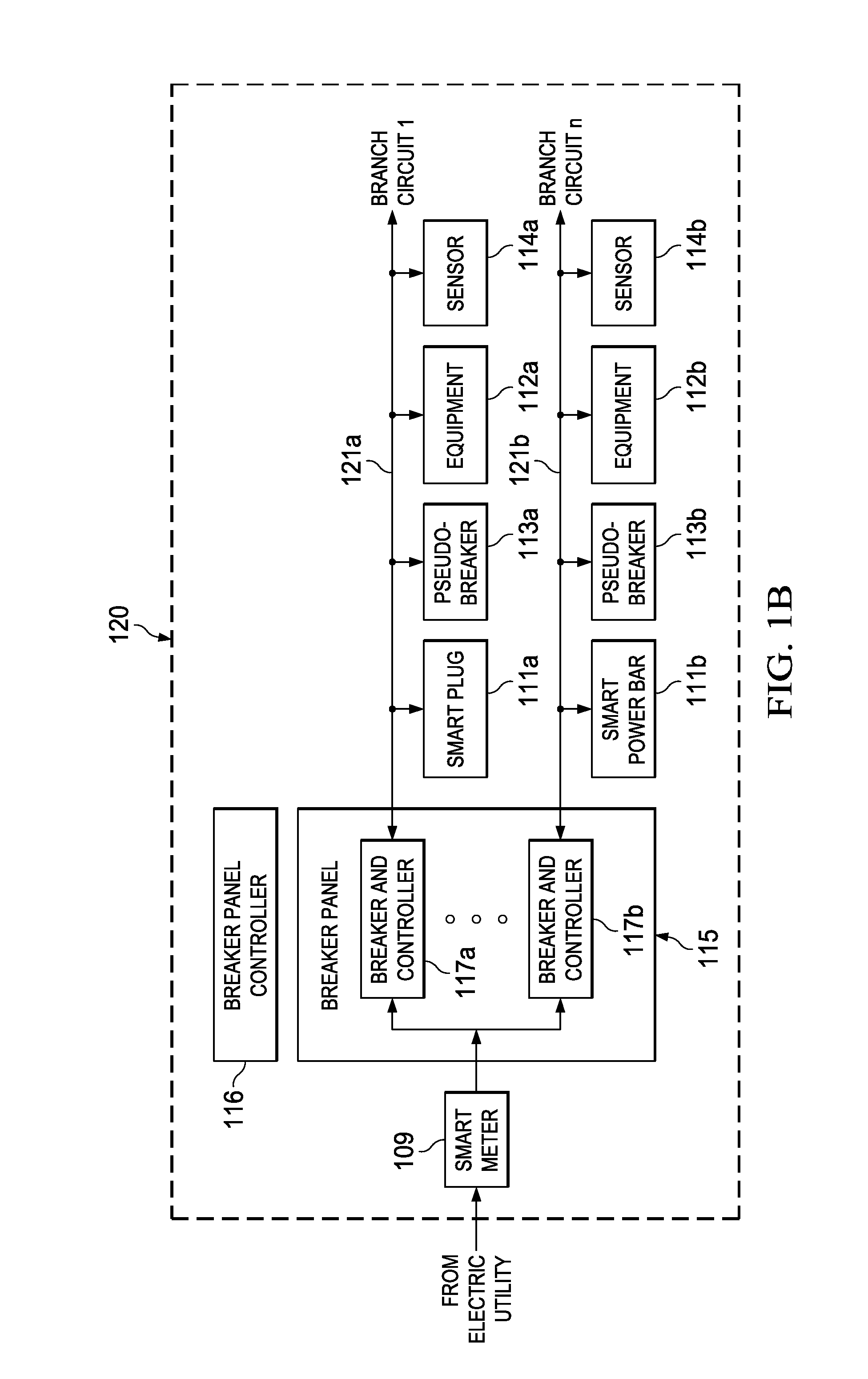

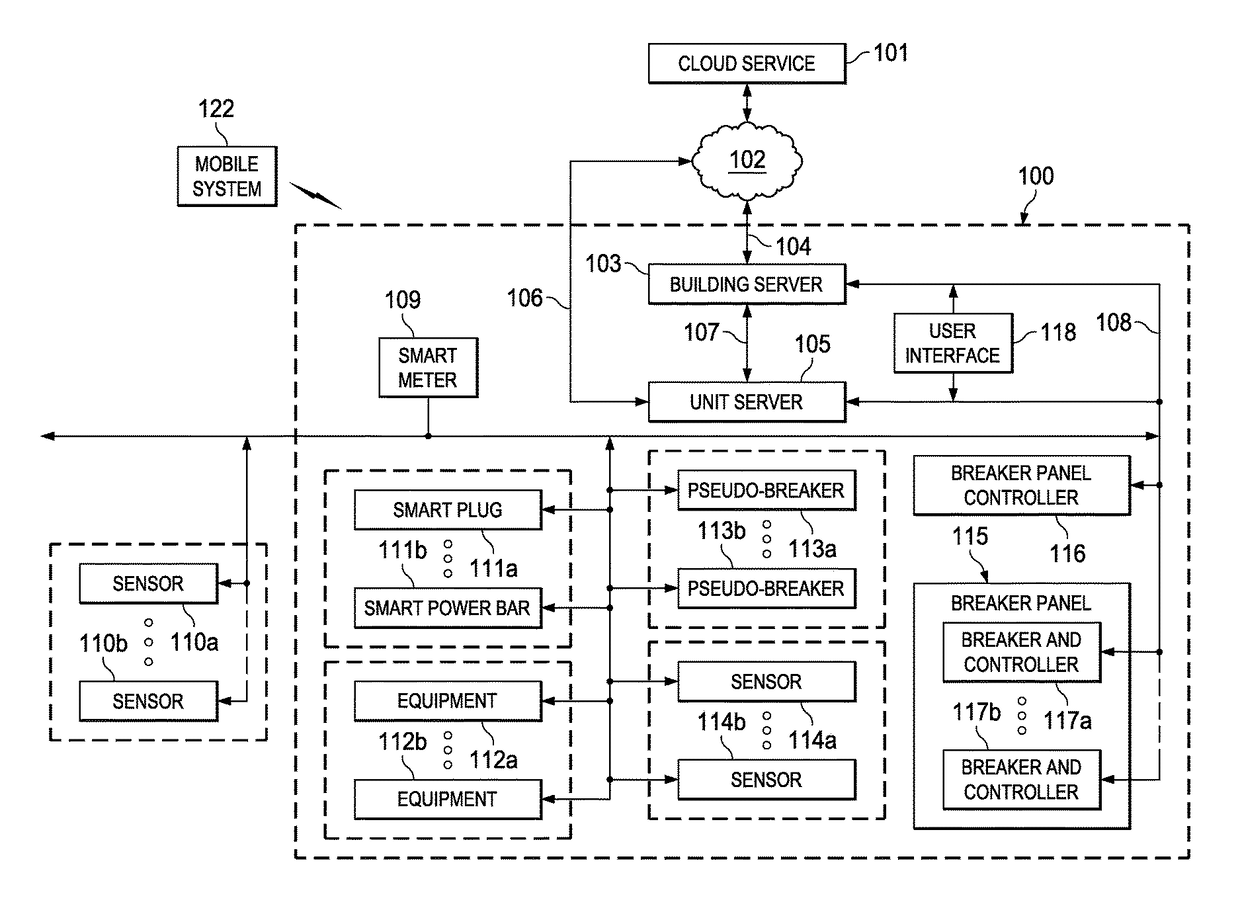

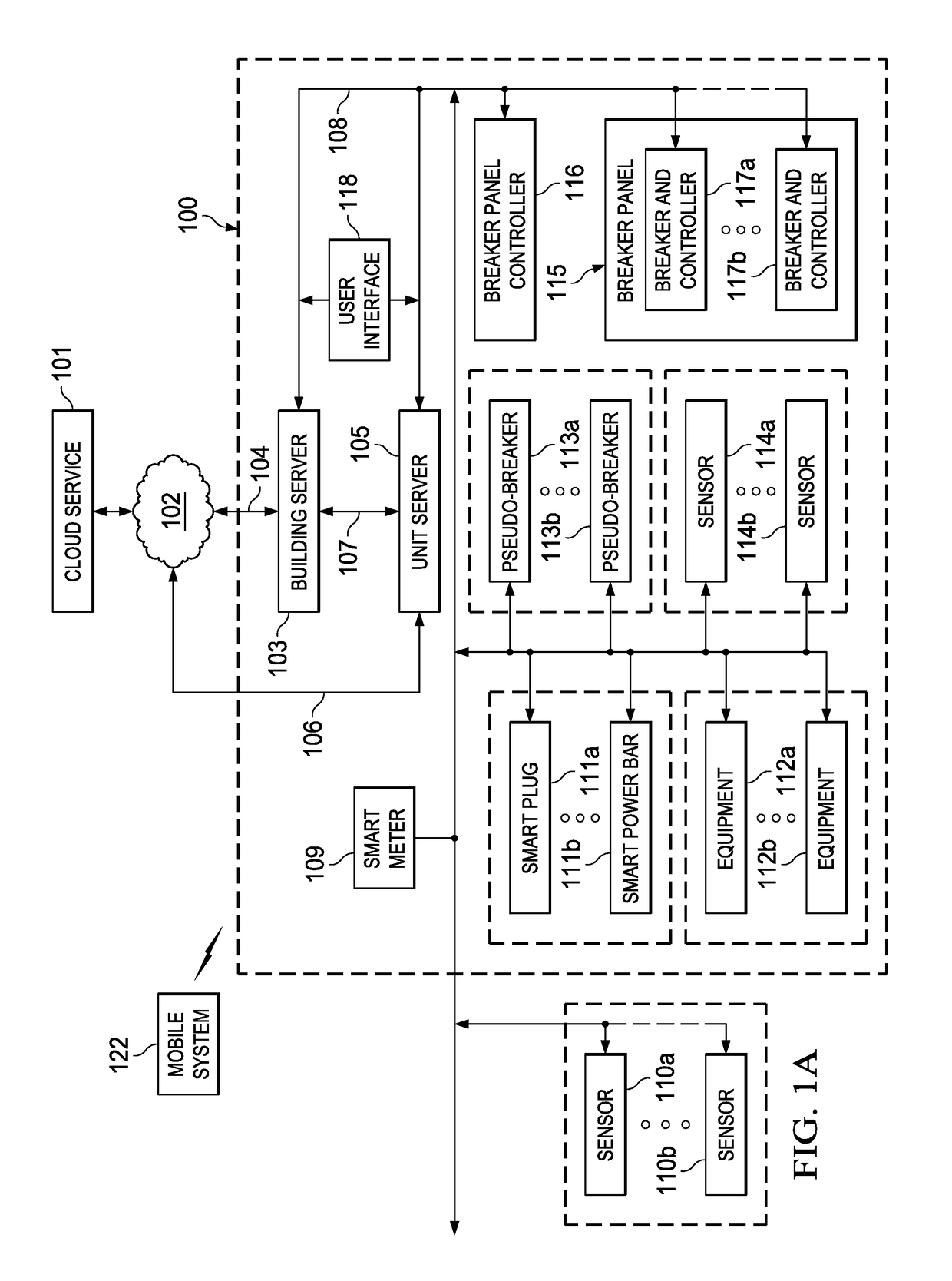

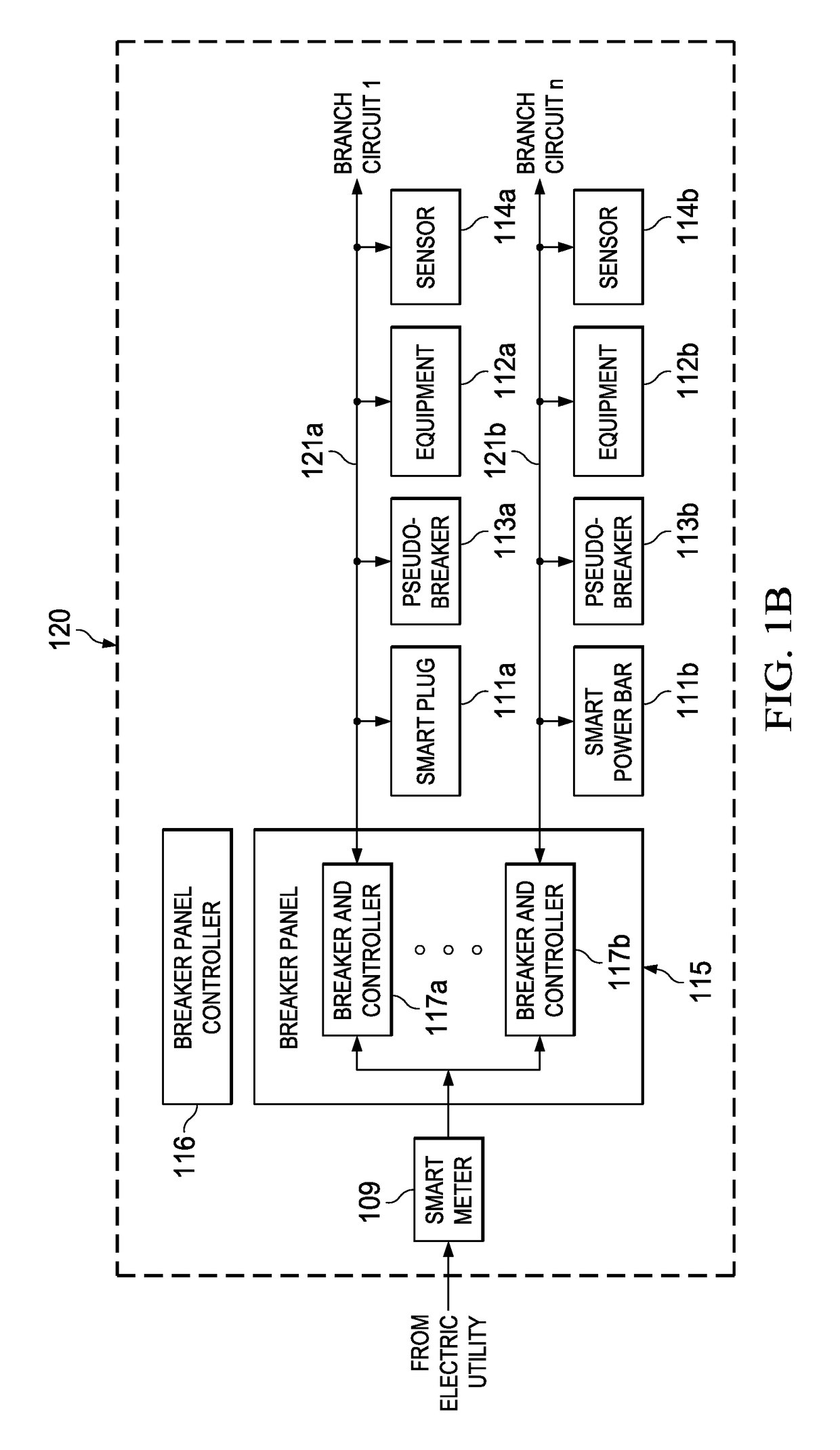

Integrated hazard risk management and mitigation system

ActiveUS20160163186A1Reduce riskQuick identificationProgramme controlData processing applicationsData processing systemIT risk management

A system for hazard mitigation in a structure including a subsystem coupled to a circuit of an electrical distribution system and set of nodes. The nodes monitor operating conditions of the circuit and generate data in response. A data processing system is operable to process the data generated by the set of nodes and in response identify a trigger representing a condition requiring that an action be taken. The data processing system processes the trigger in accordance with a predetermined policy to initiate an action by the subsystem.

Owner:UNILECTRIC LLC

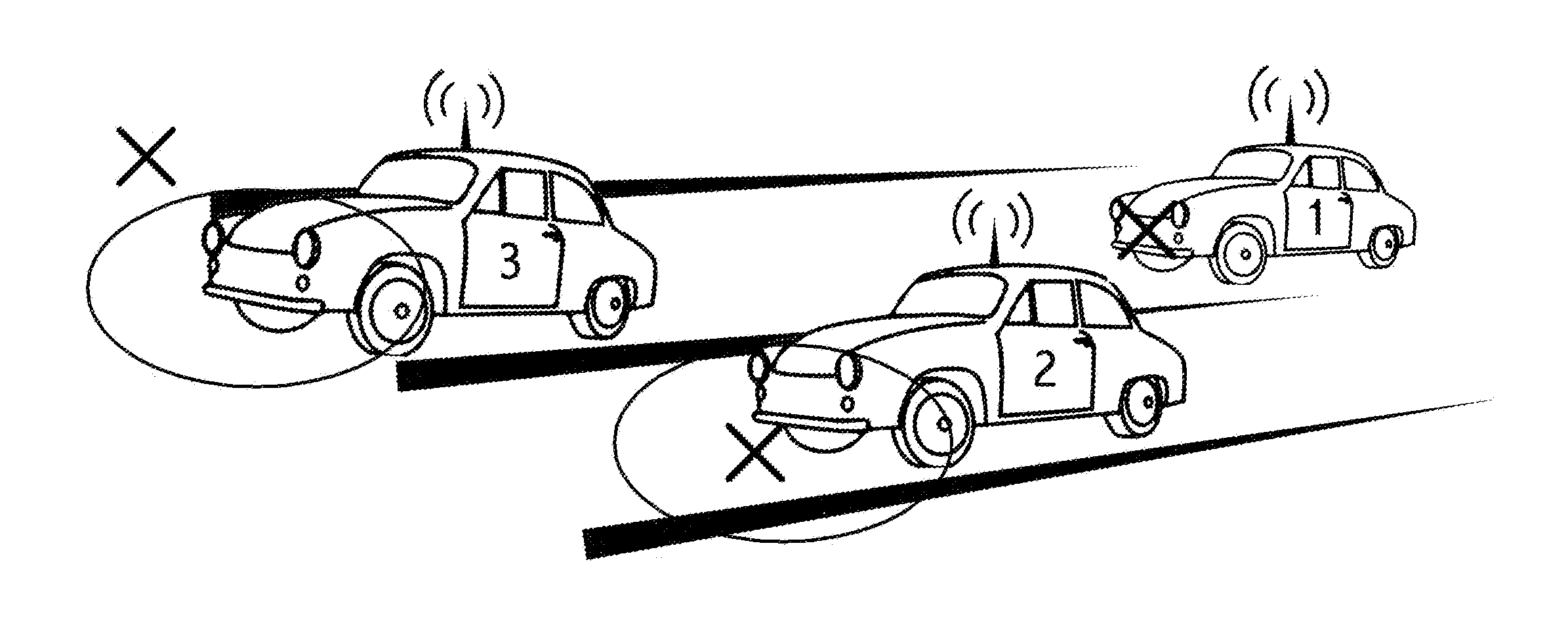

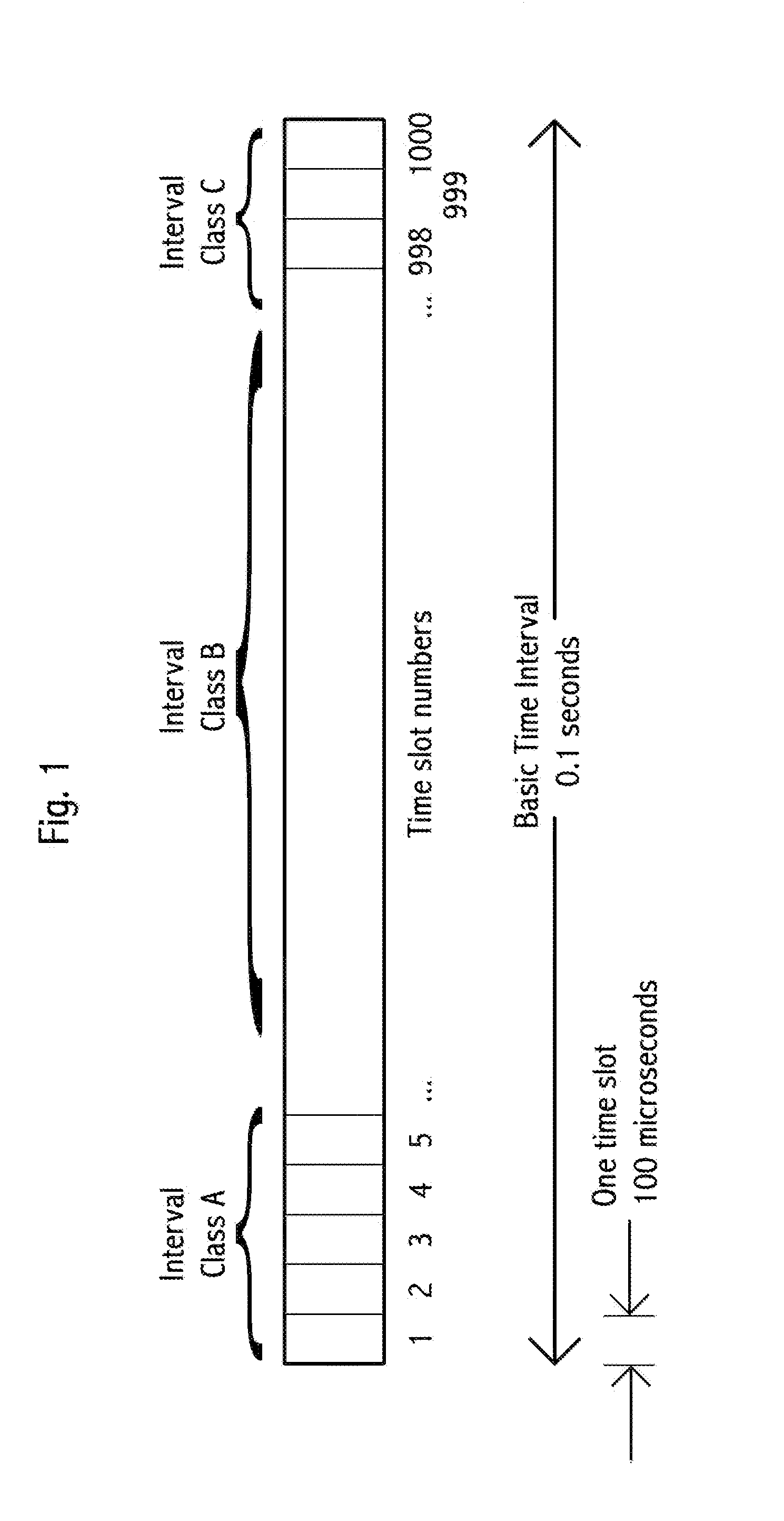

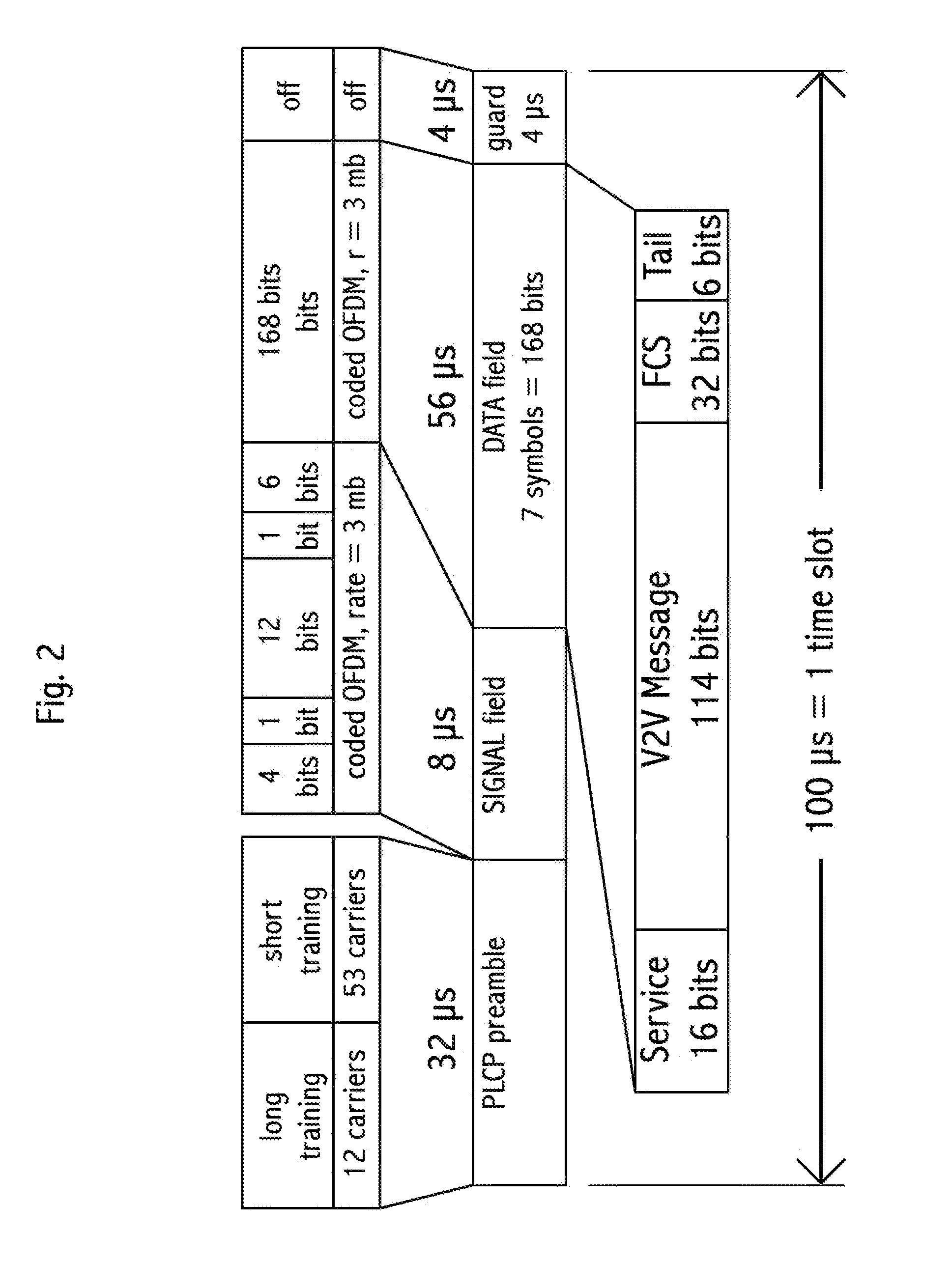

Risk management in a vehicle Anti-collision system

ActiveUS20130278442A1More dataInstruments for road network navigationArrangements for variable traffic instructionsCommunications systemIT risk management

Device, system and method, in a vehicle communication system, of transmitting a risk value in a message, wherein the risk value identifies quantitatively a risk of vehicle collision. Embodiments determine risk value by combining sub-risk values wherein sub-risks comprise: (i) vehicle behavior; (ii) weather and road conditions; (iii) current traffic; and (iv) location history. Embodiments include driver warnings responsive to the risk value in a received message. Embodiments include a collision type in a message. Embodiments include unique features of: risk is applicable to receiving vehicles; risk is applicable to a geographical region; computation and storage of location histories; messages free of IP and MAC addresses; haptic devices used for driver warning.

Owner:ZETTA RES & DEV - FORC SERIES

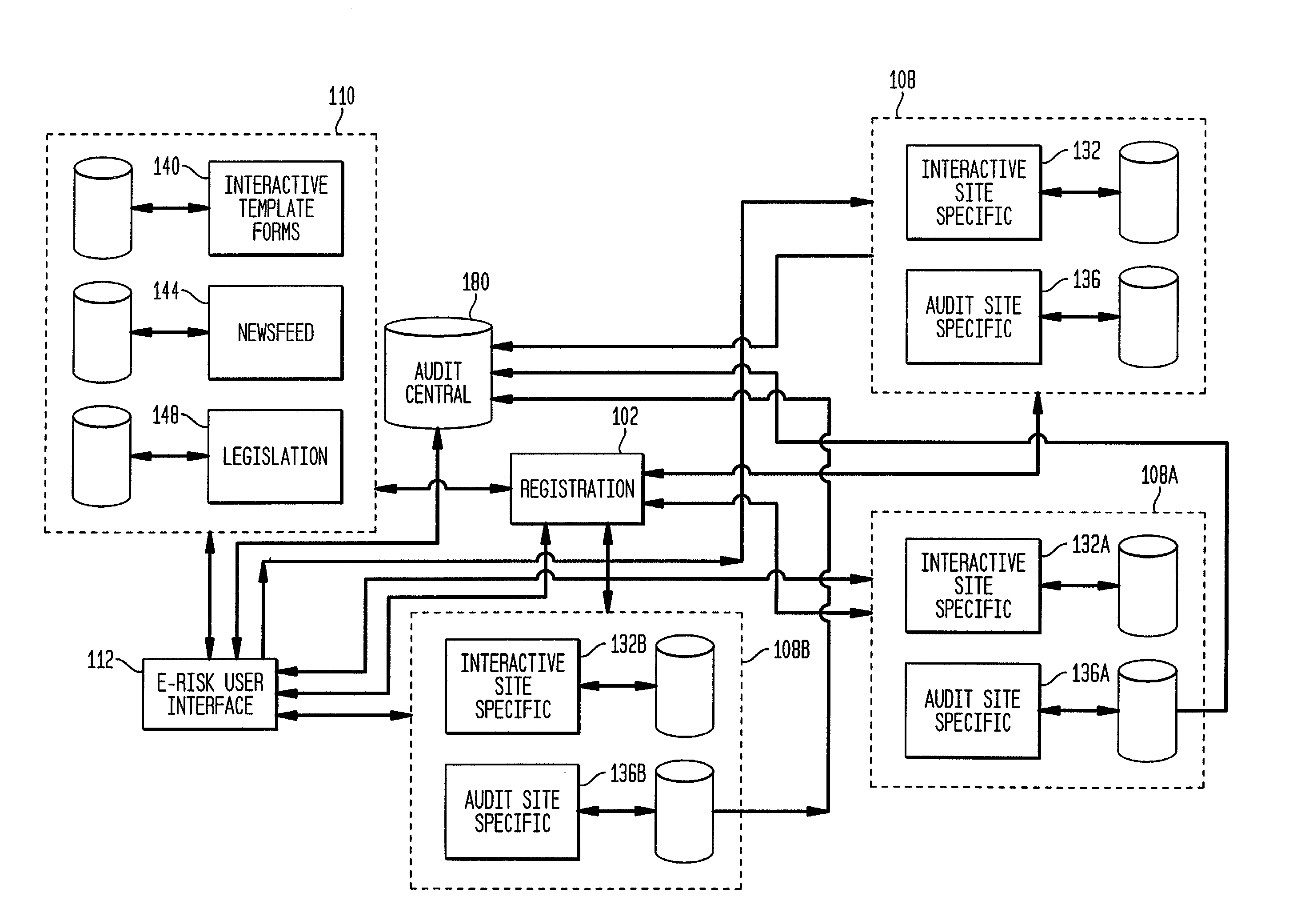

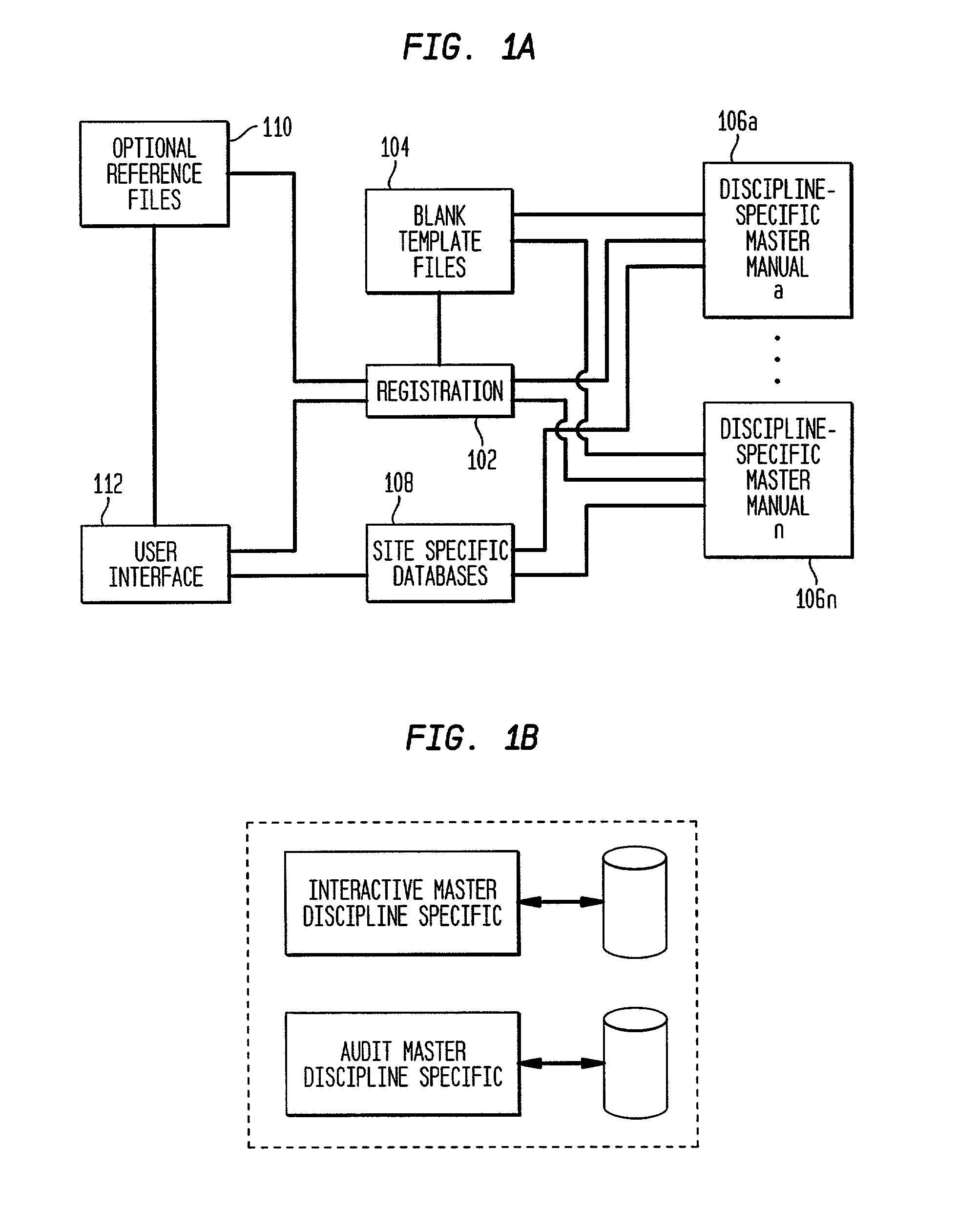

Method, system, and computer program product for risk assessment and risk management

Owner:NAT BRITANNIA GROUP

Method of risk management and of achieving a recommended asset allocation and withdrawal strategy, and computer-readable medium, apparatus and computer program thereof

Owner:AMERIPRISE FINANCIAL

Method and apparatus for risk management

InactiveUS7130779B2Quickly and easily buildDetermine effectivenessHand manipulated computer devicesFinanceIT risk managementPersistent object

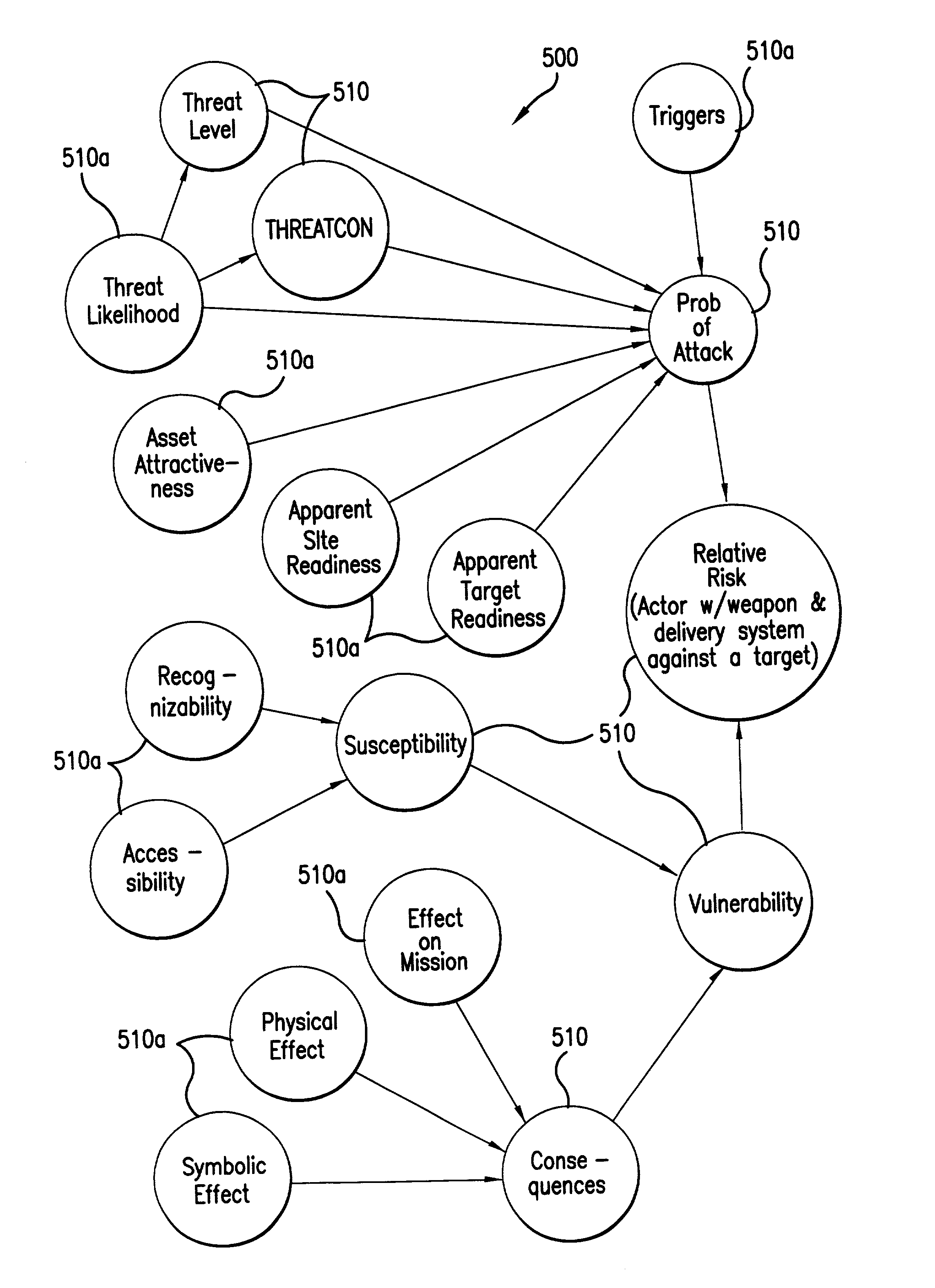

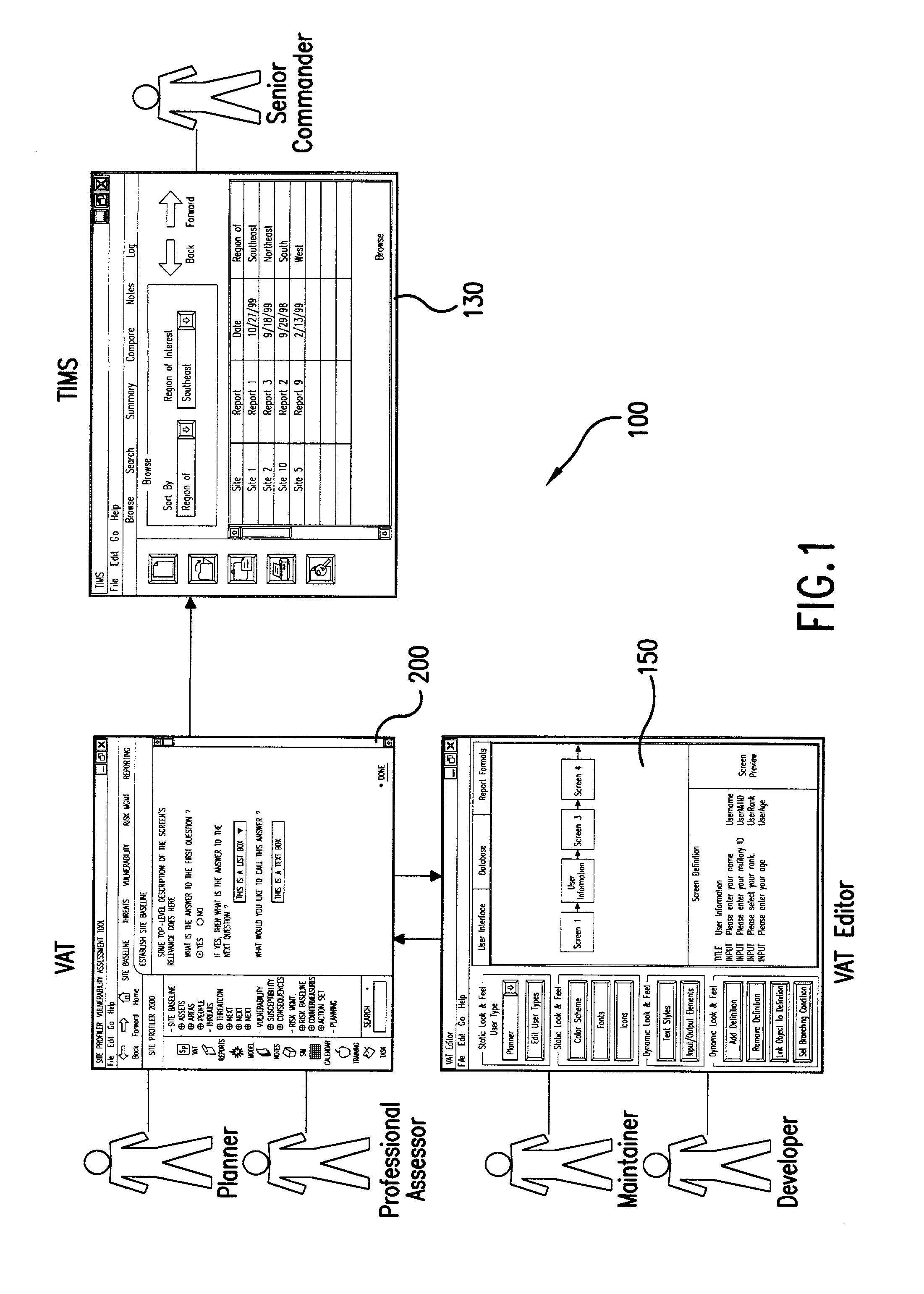

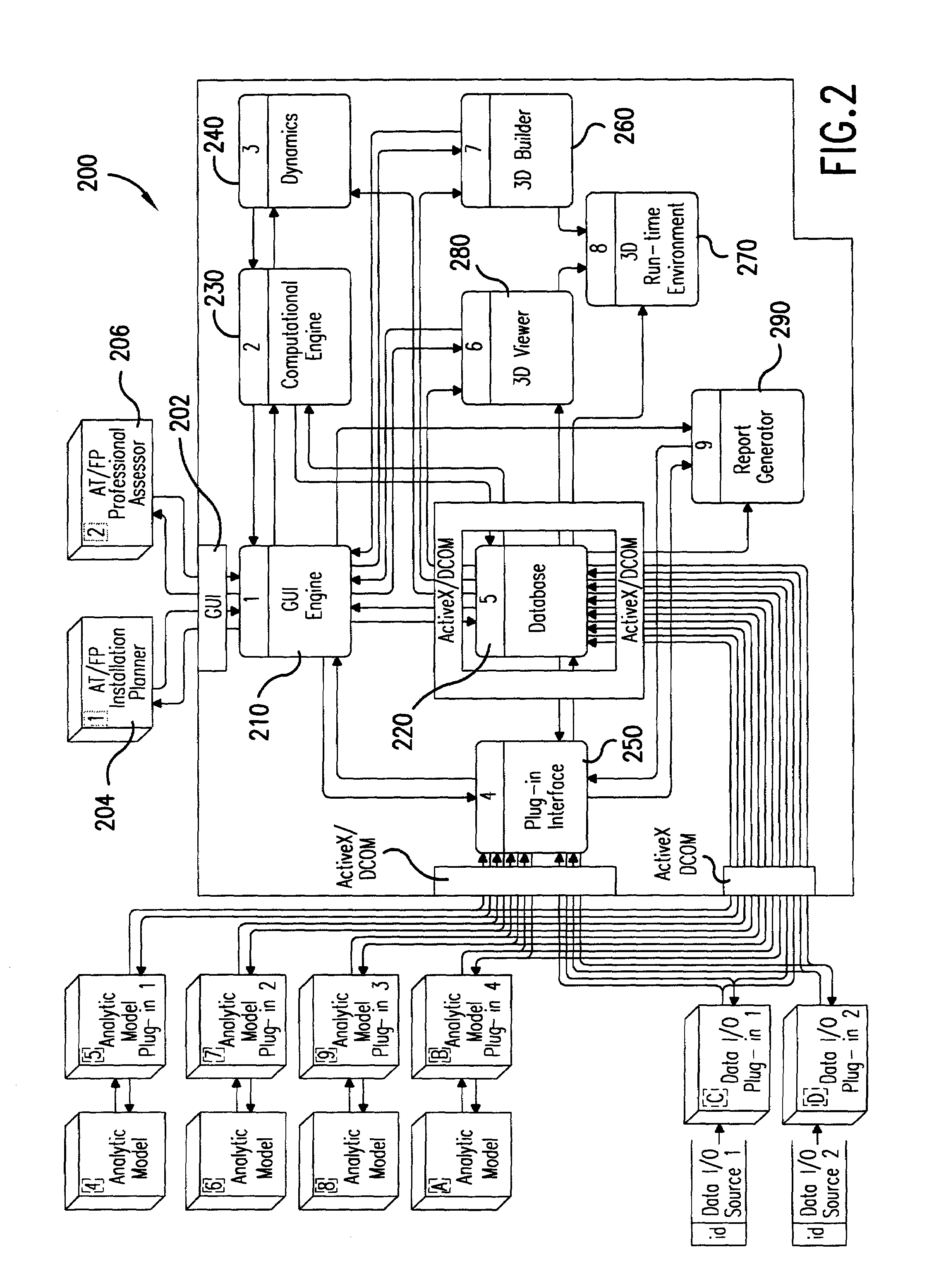

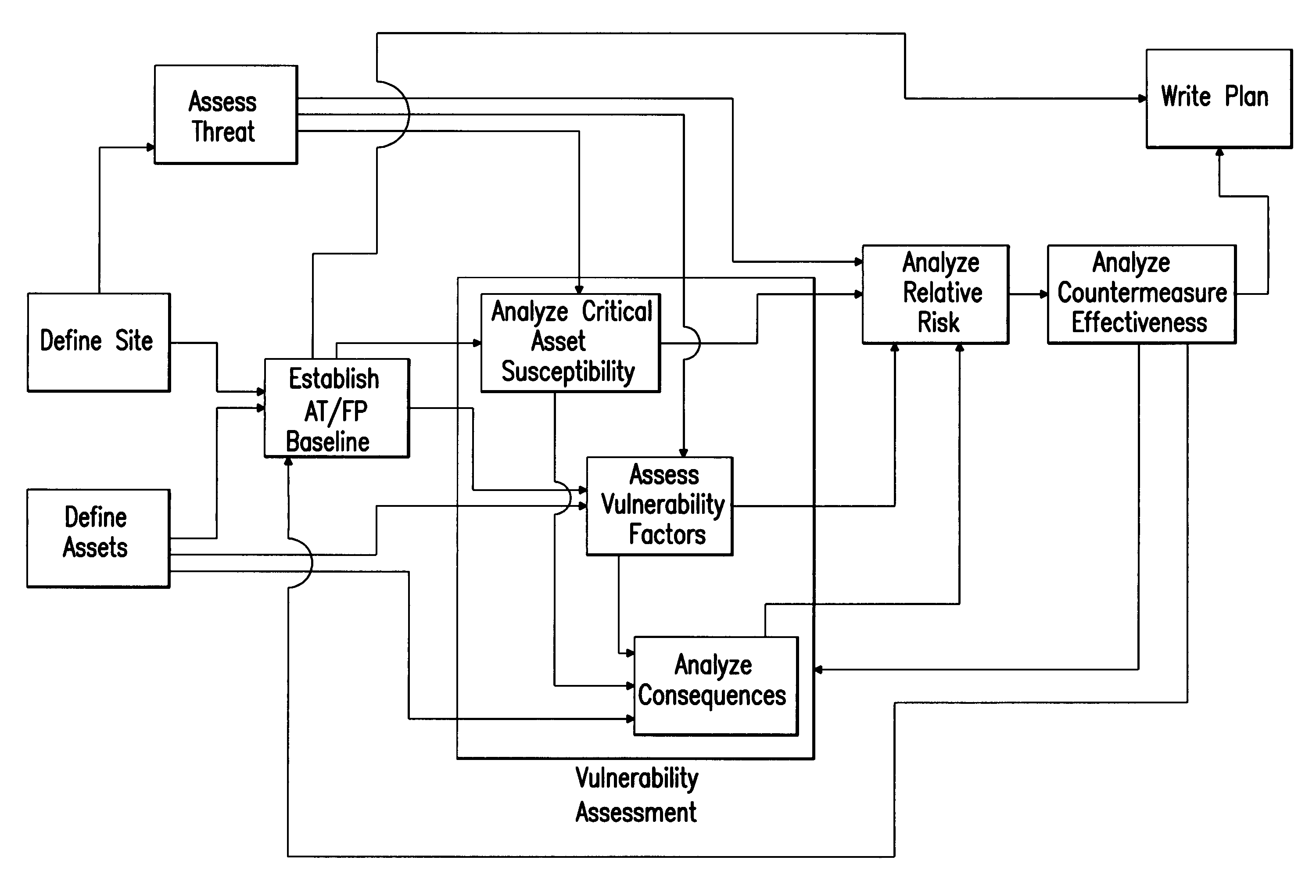

An integrated risk management tool includes a persistent object database to store information about actors (individuals and / or groups), physical surroundings, historical events and other information. The risk management tool also includes a decision support system that uses data objects from the database and advanced decision theory techniques, such as Bayesian Networks, to infer the relative risk of an undesirable event. As part of the relative risk calculation, the tool uses a simulation and gaming environment in which artificially intelligent actors interact with the environment to determine susceptibility to the undesired event. Preferred embodiments of the tool also include an open “plug-in” architecture that allows the tool to interface with existing consequence calculators. The tool also provides facilities for presenting data in a user-friendly manner as well as report generation facilities.

Owner:DIGITAL SANDBOX

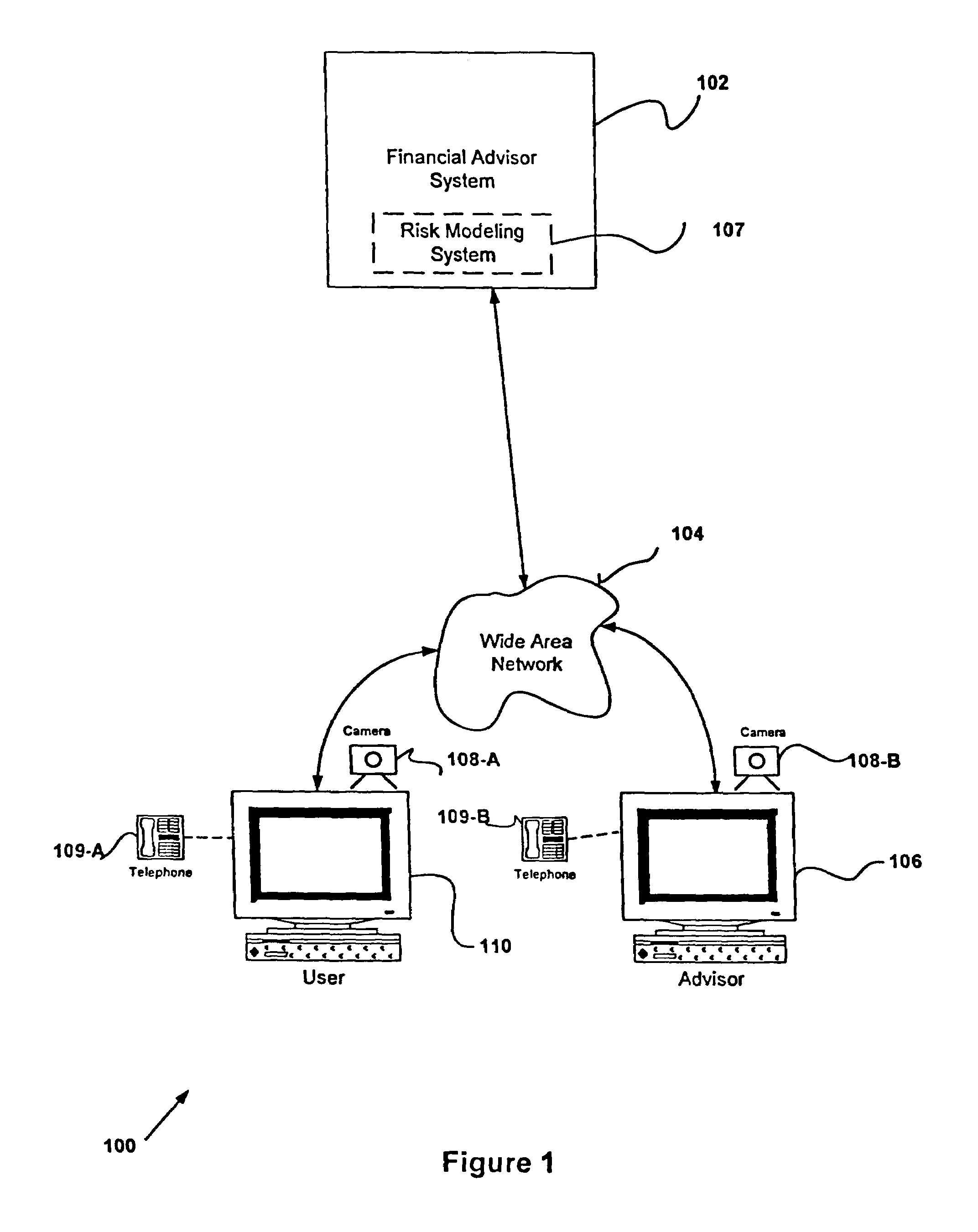

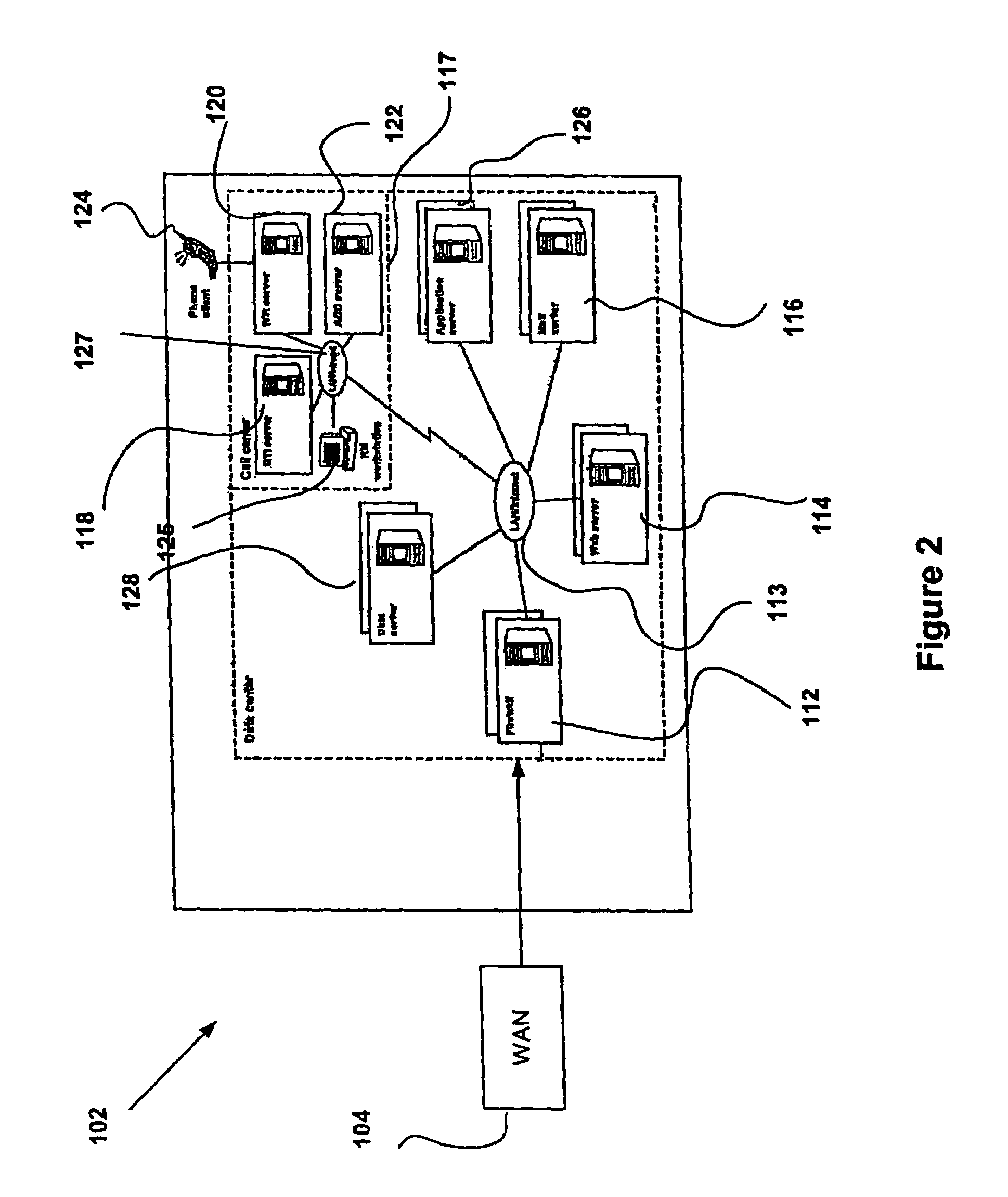

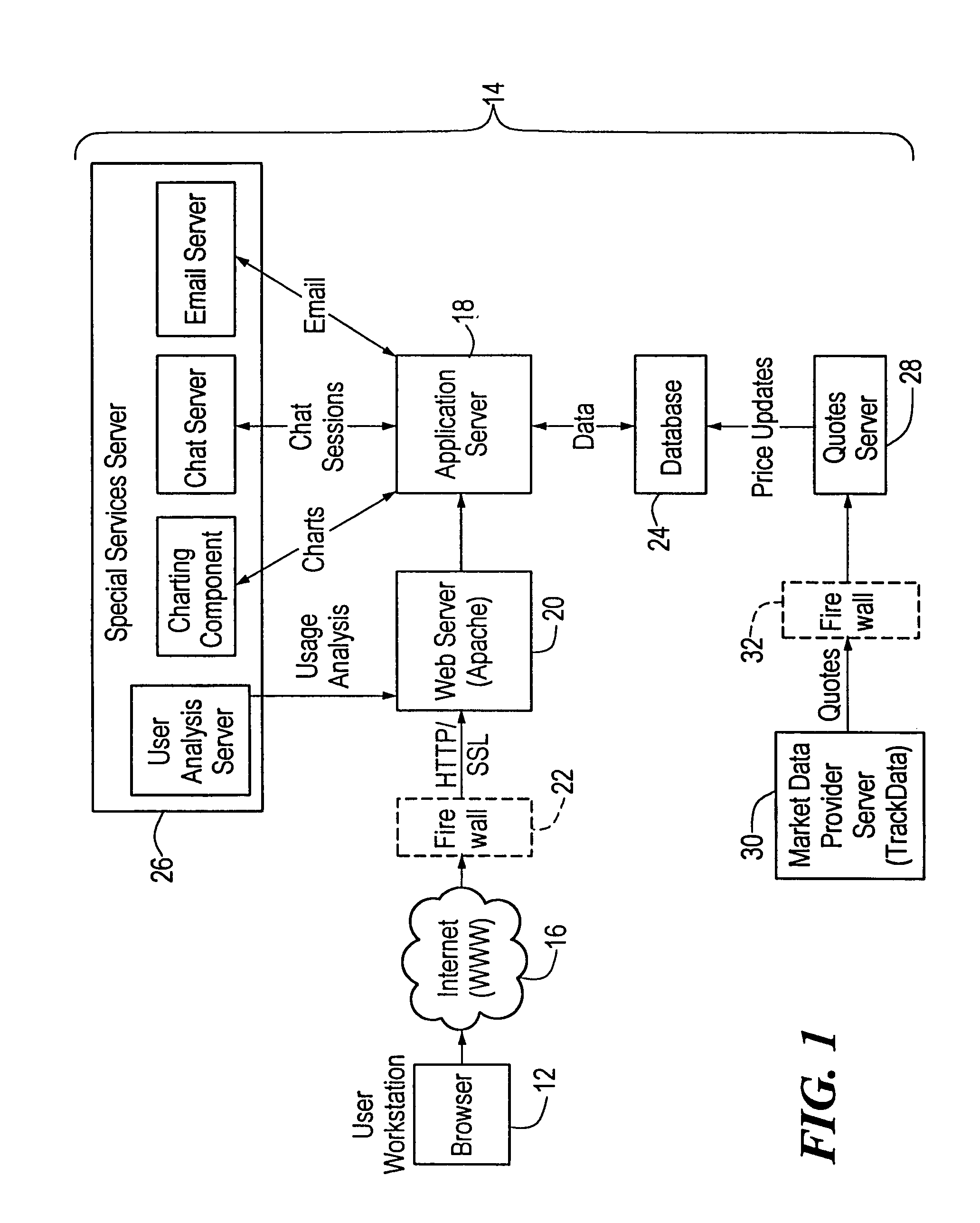

Automated financial portfolio coaching and risk management system

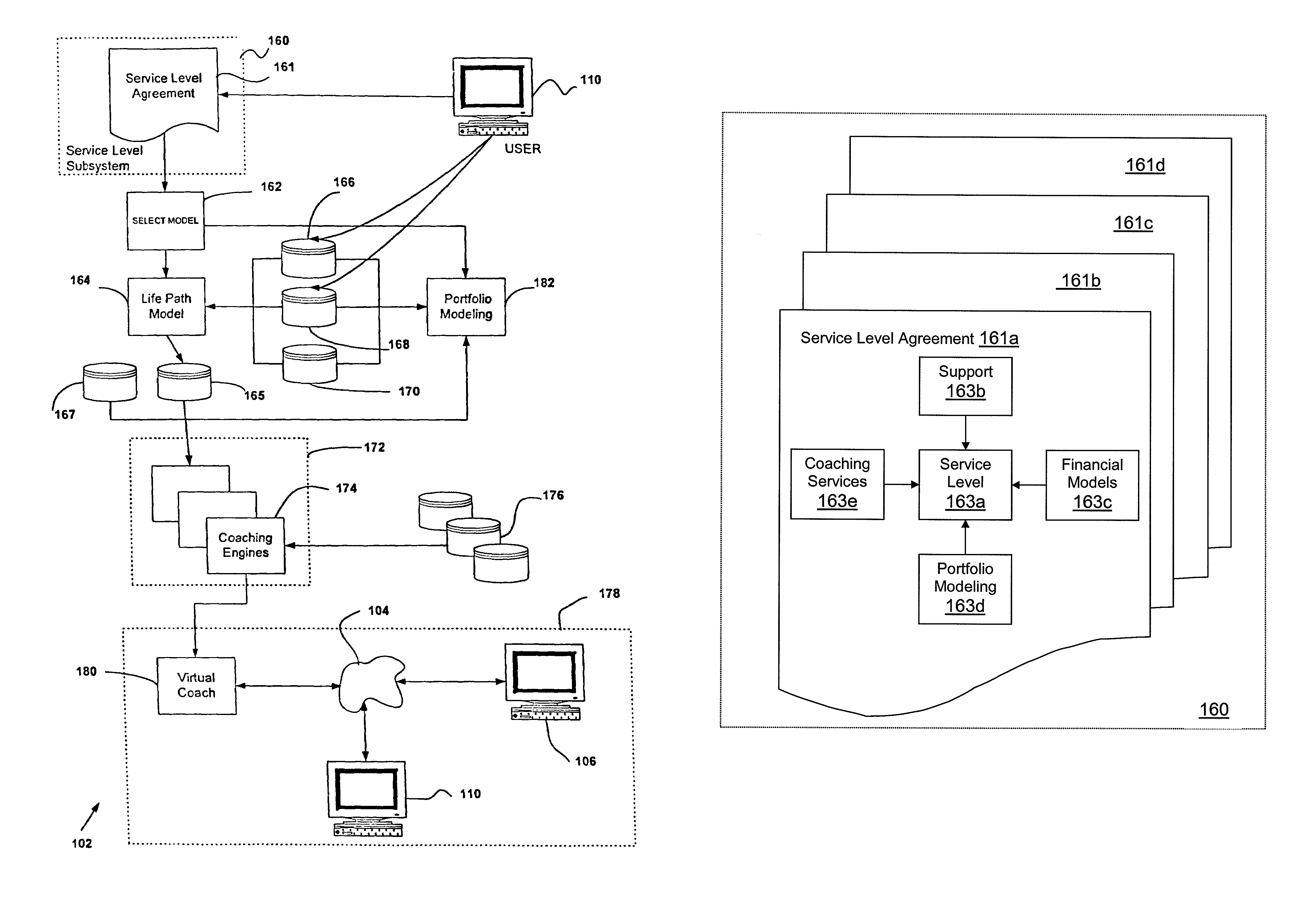

InactiveUS7831494B2Avoid unaffordable lossEasy to pickFinanceElectric digital data processingIT risk managementCollaborative computing

The present invention relates to an Internet enabled, interactive financial portfolio risk modeling system. The system operates online, in a collaborative computing environment between the user and the portfolio development system. The portfolio generating system models the user's personal investment parameters into a user profile in terms of the user risk tolerance level, user investment style and user bull / bear attitude. The system further calculates Value At Risk (VAR) values for the user. The system filters various securities based on their VAR and Beta values and present two list of filtered securities, with opposing Beta values, matching the user profile. The present invention enables the user to swap securities in and out of his existing portfolio and receive an analysis of the effect of the swap on his portfolio. The model also generates an ideal portfolio based on the user profile. The present invention presents the user with an estimated value of his portfolio, based on a regression formula as well as a possible best and worst scenario based on statistical formulas particularly to computer implemented, Internet based financial modeling systems.

Owner:UNITED SYNDICATE INSURANCE +1

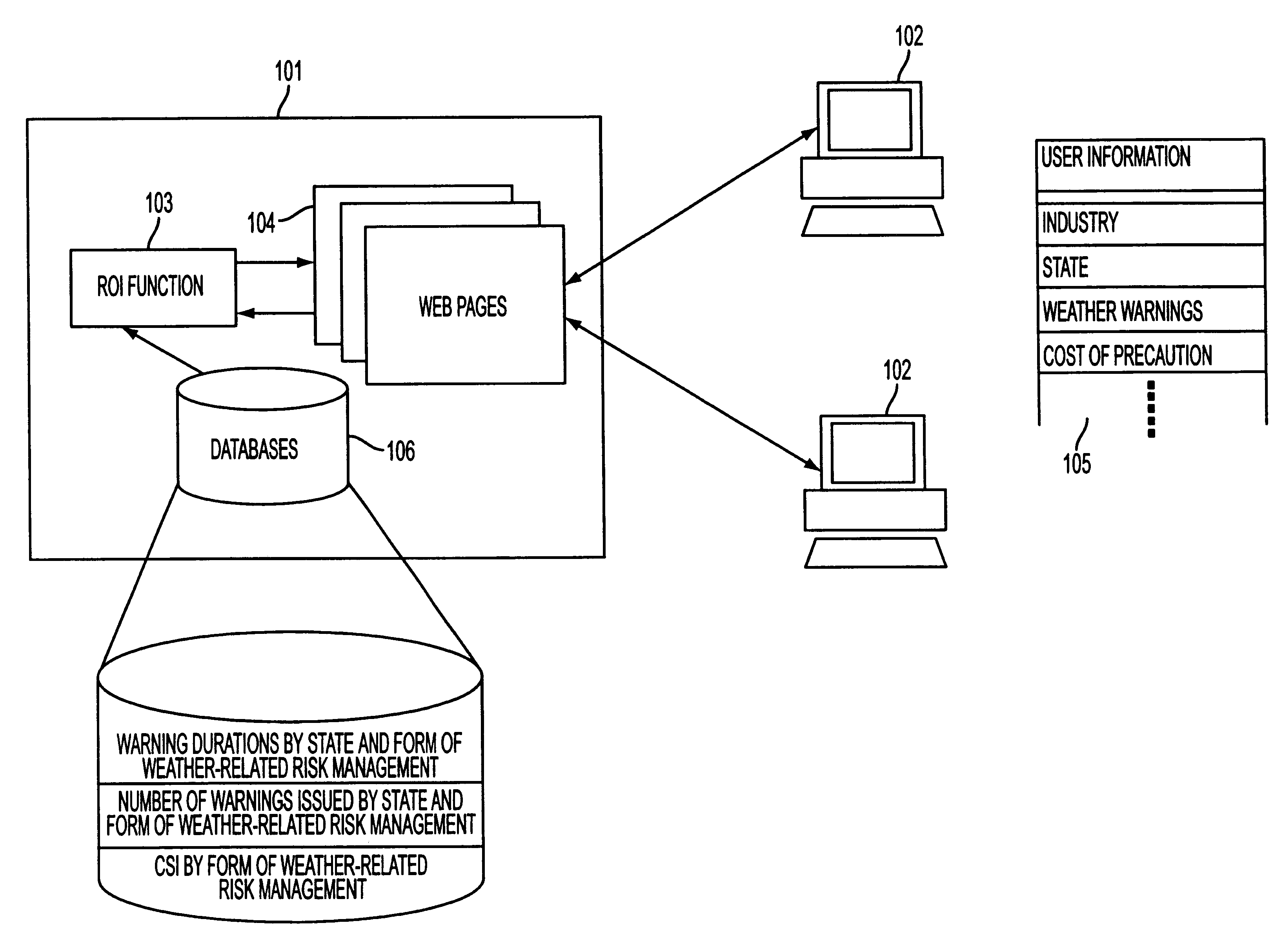

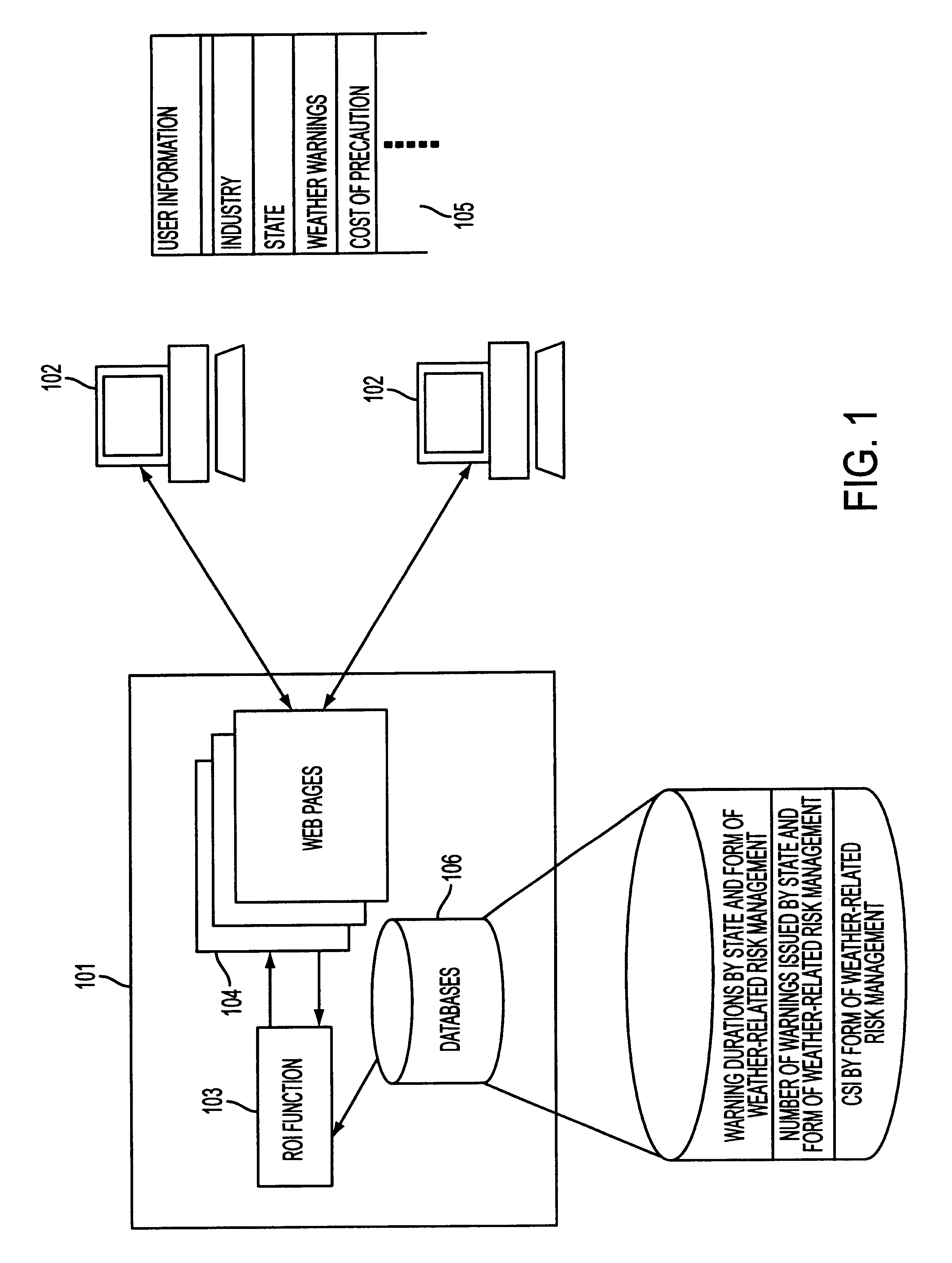

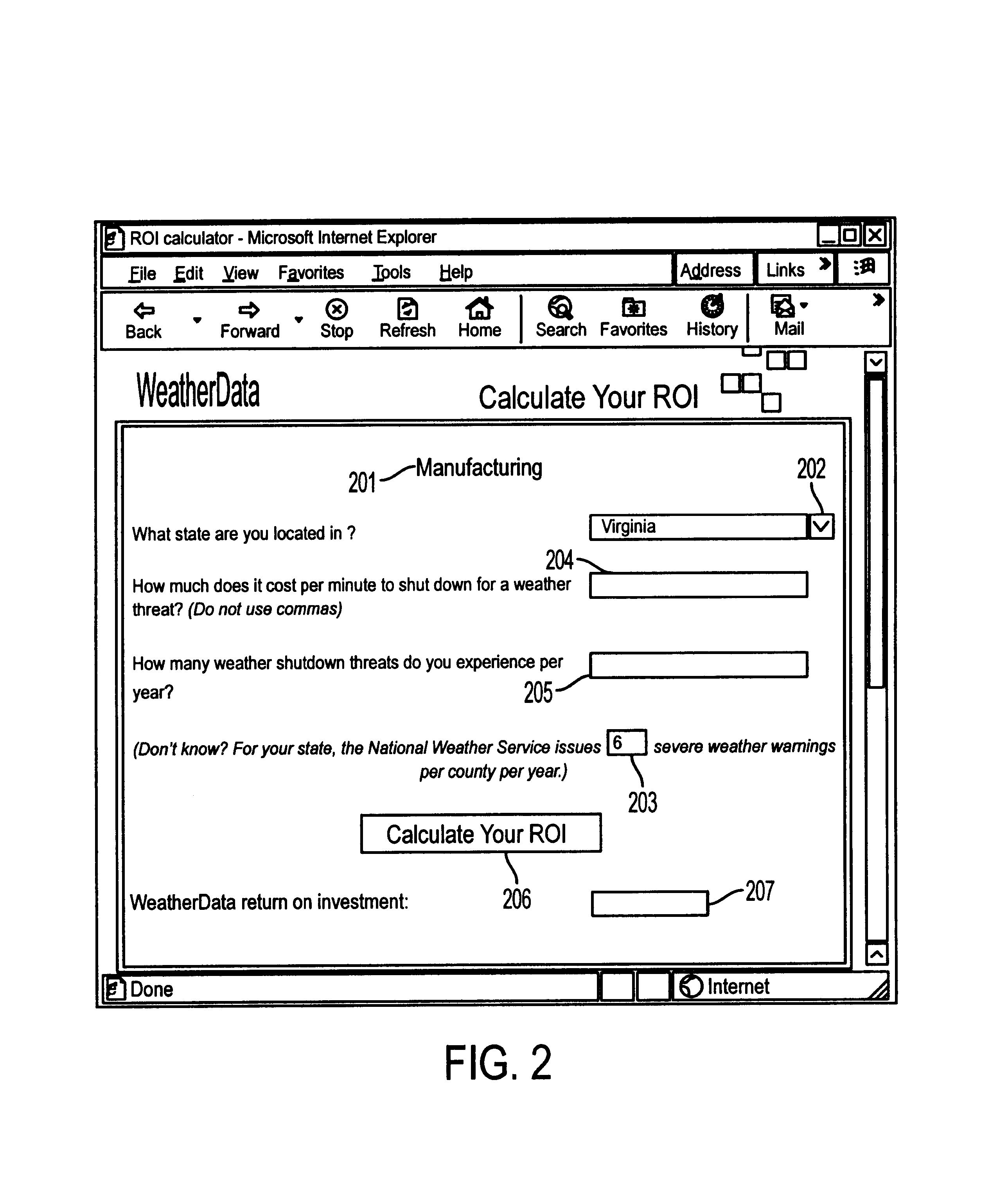

Method and apparatus for calculating a return on investment for weather-related risk management

A computer-implemented method and system evaluates and displays a return on investment for using weather-related risk-management services. The system includes user interfaces, databases containing information about the accuracy of different forms of weather-related risk-management services and the types and frequency of weather events in different geographical areas, and return on investment functions. The system accepts information about a user's costs of responding to weather warnings and events, retrieves information from its databases and applies the appropriate function to determine a return on investment. The result is then displayed to the user. The method determines the costs of weather-related risks faced by a user under two different risk-management services and compares them, determining a return on investment for the use of one service over the other.

Owner:USER CENTRIC IP

Multiple open order risk management and management of risk of loss during high velocity market movement

The disclosed embodiments relate to a mechanism which may restrict or otherwise manage the extent of exposure of any particular market participant within the price movement threshold of a market protection system which interrupts market activity during extreme events, as well as to a mechanism for controlling risk of loss which acts to reduce or otherwise manage a market participant's ability to concentrate their exposure, or risk of loss, within a range of price levels and / or within correlated products that could be executed upon before the market participant, or other entity responsible for the activities thereof, e.g. a risk manager, has an opportunity to react to rapid market movement. Such a mechanism, once the market protection system had activated, e.g. by placing the market in reserve, may permit the market participant, or other party, the opportunity to modify or cancel unexecuted orders to mitigate potential losses.

Owner:CHICAGO MERCANTILE EXCHANGE

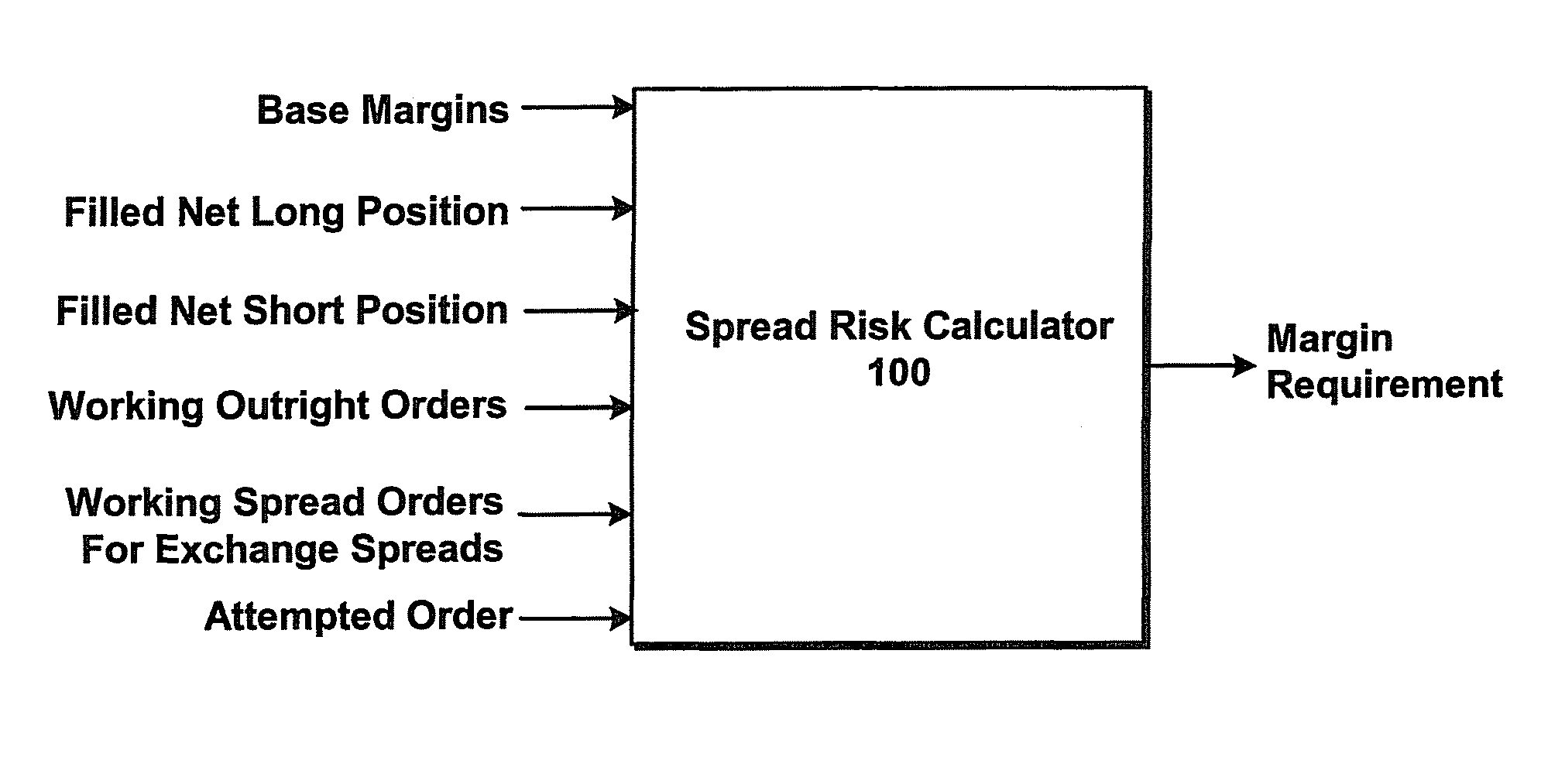

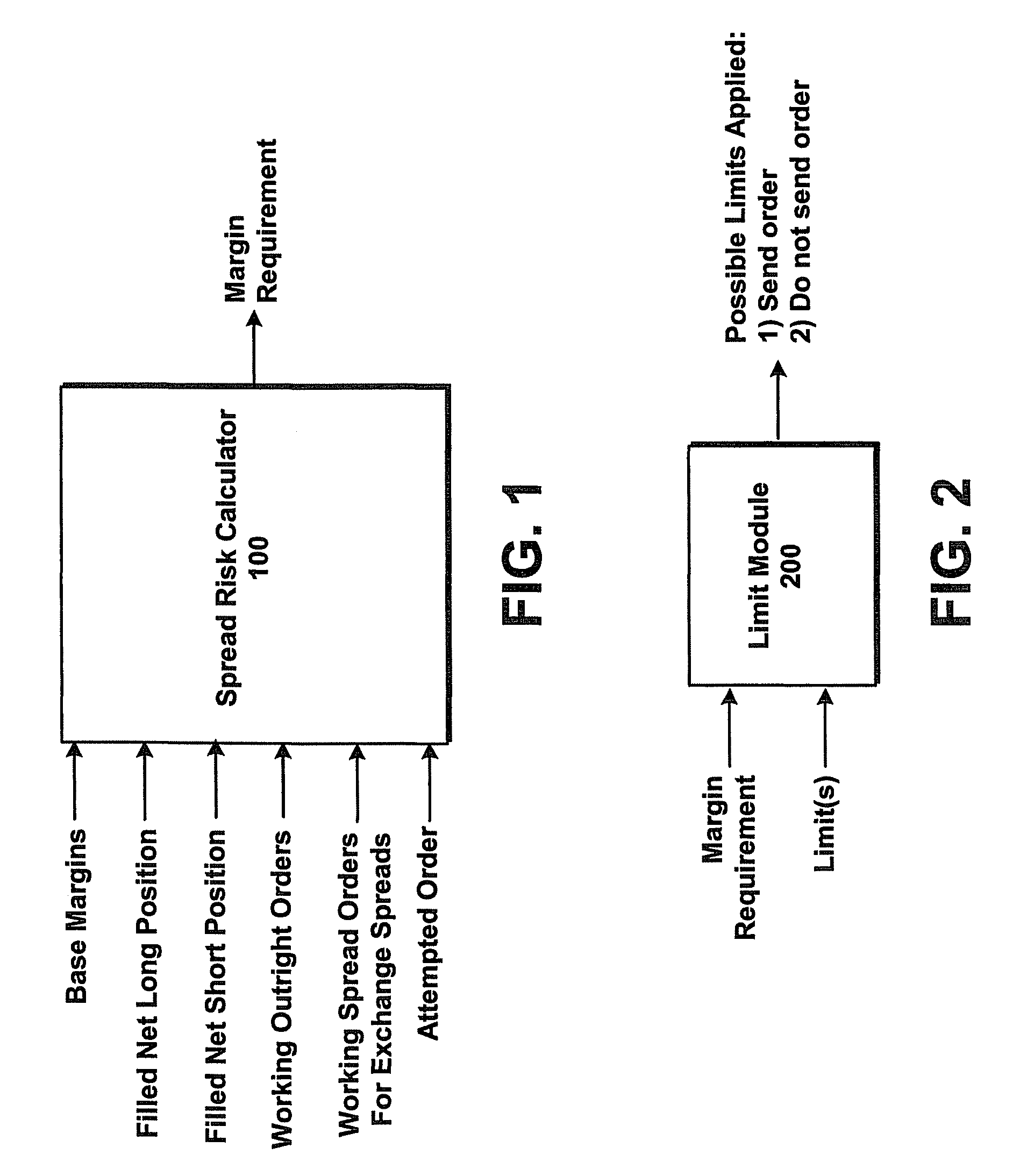

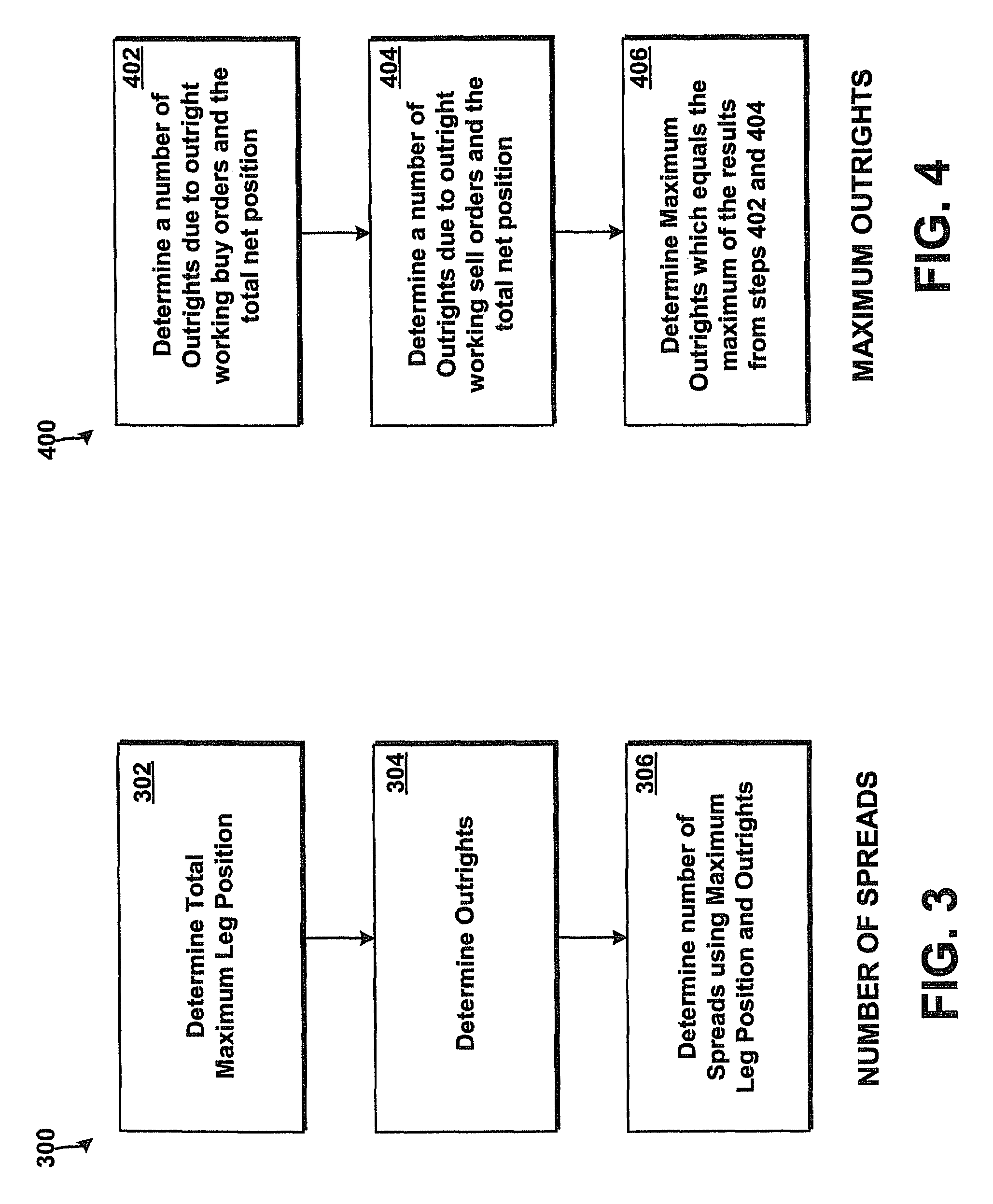

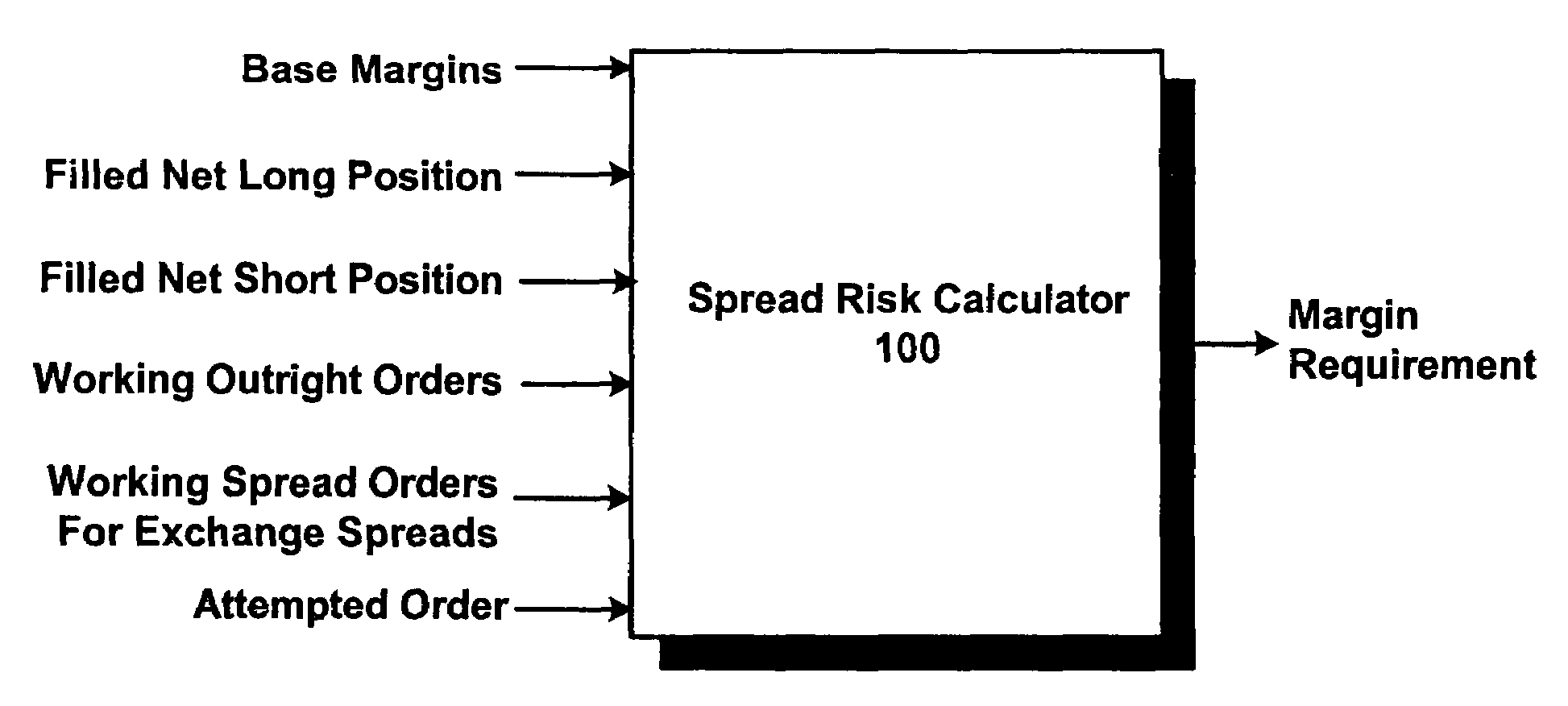

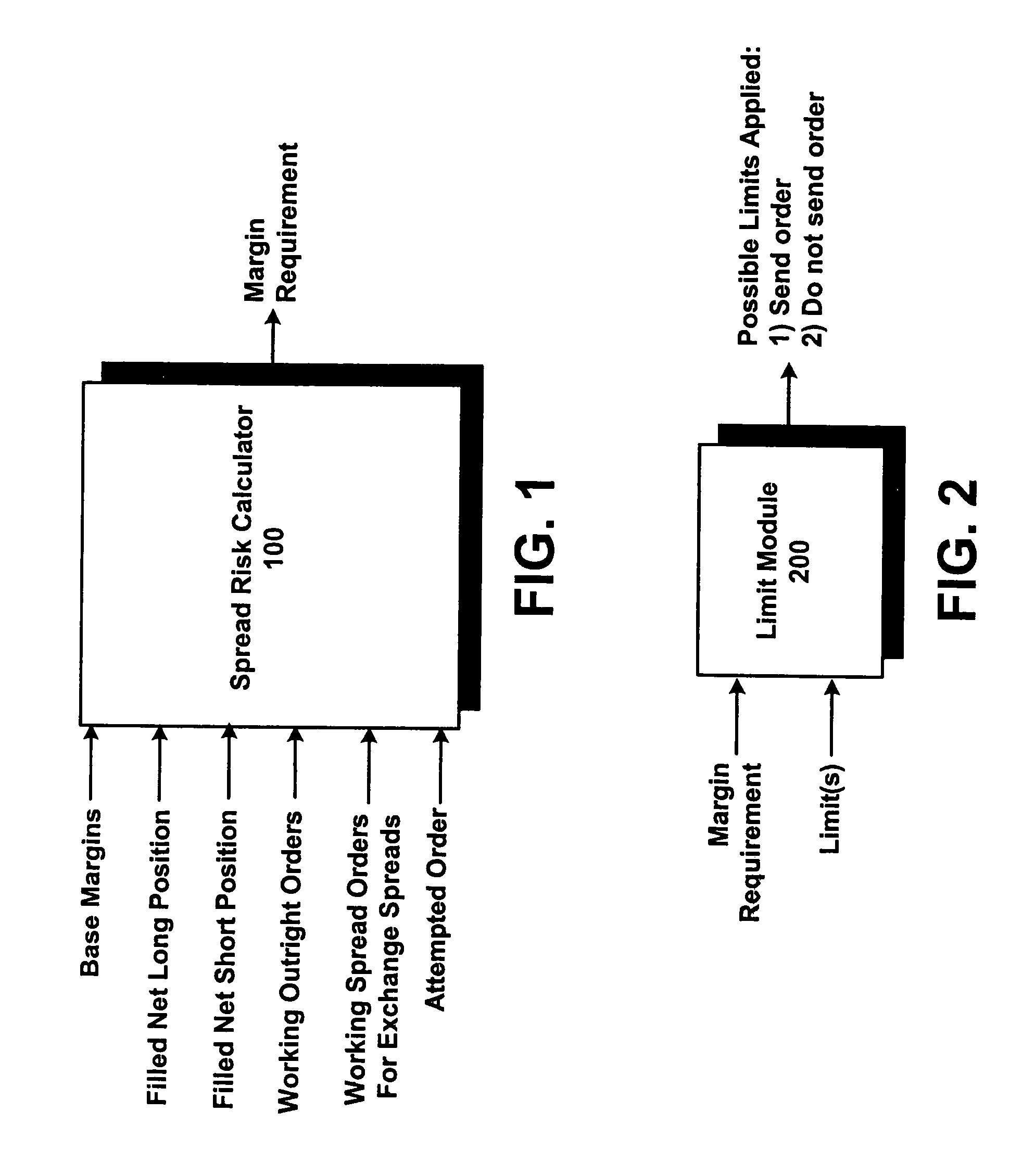

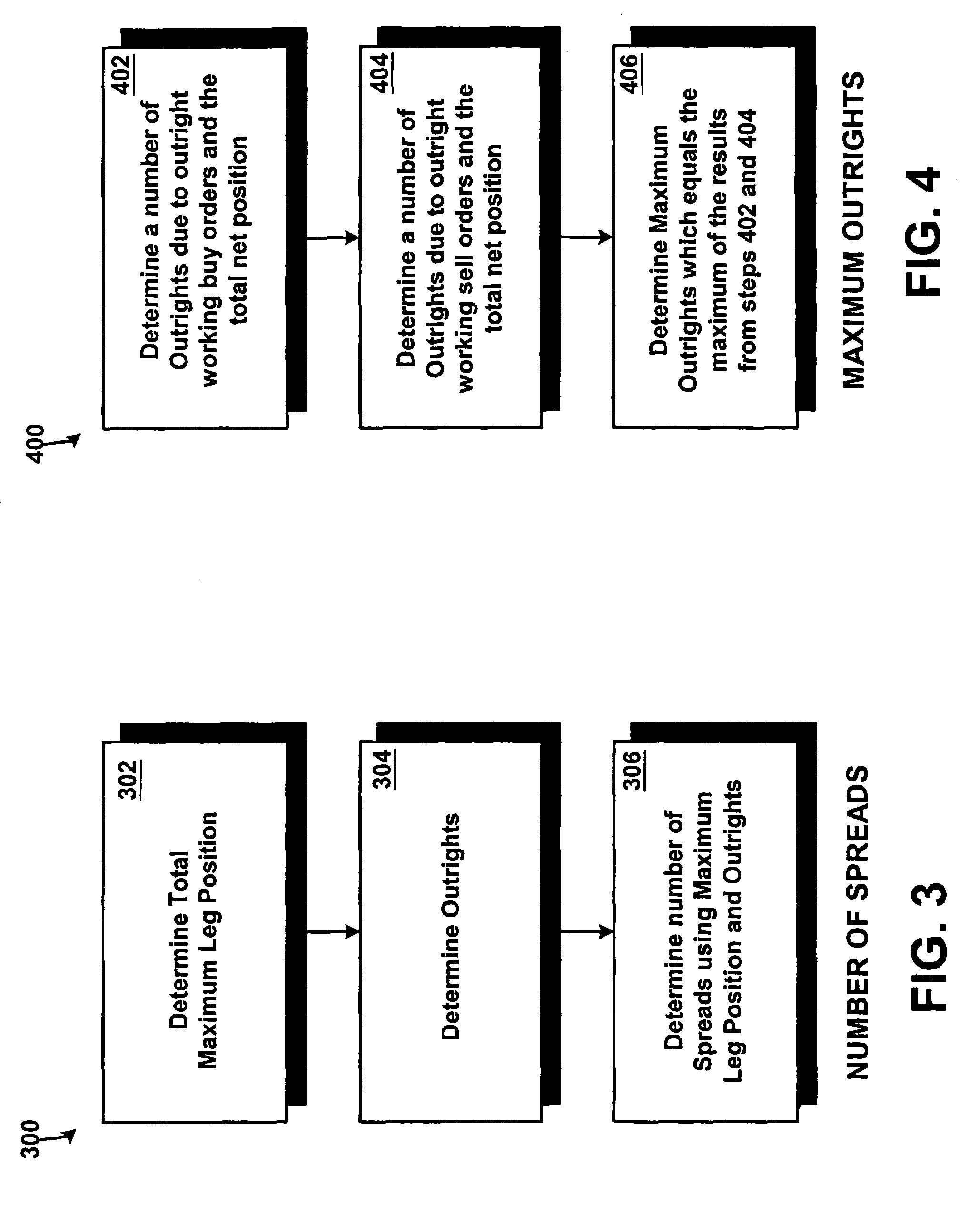

System and method for risk management

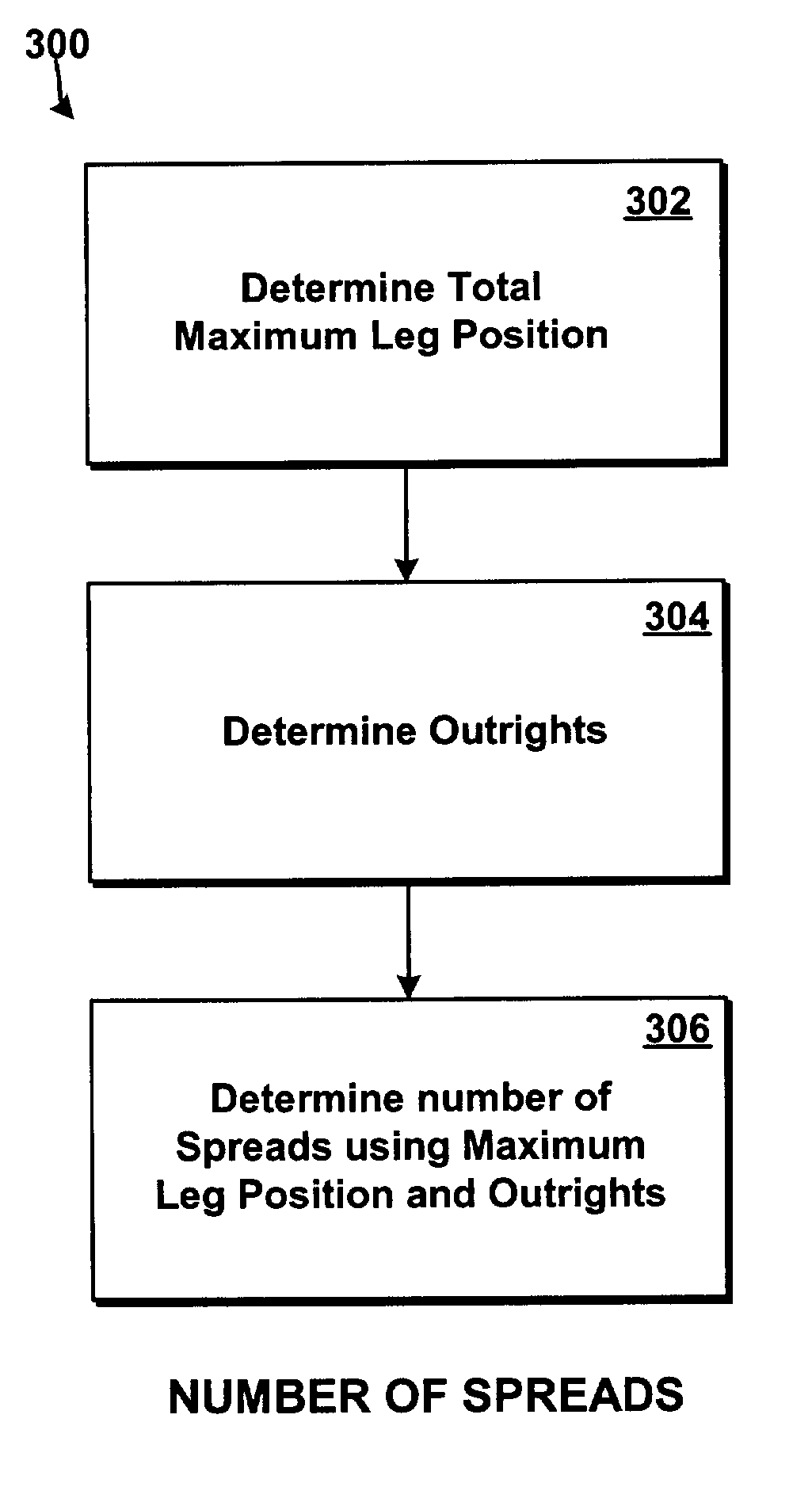

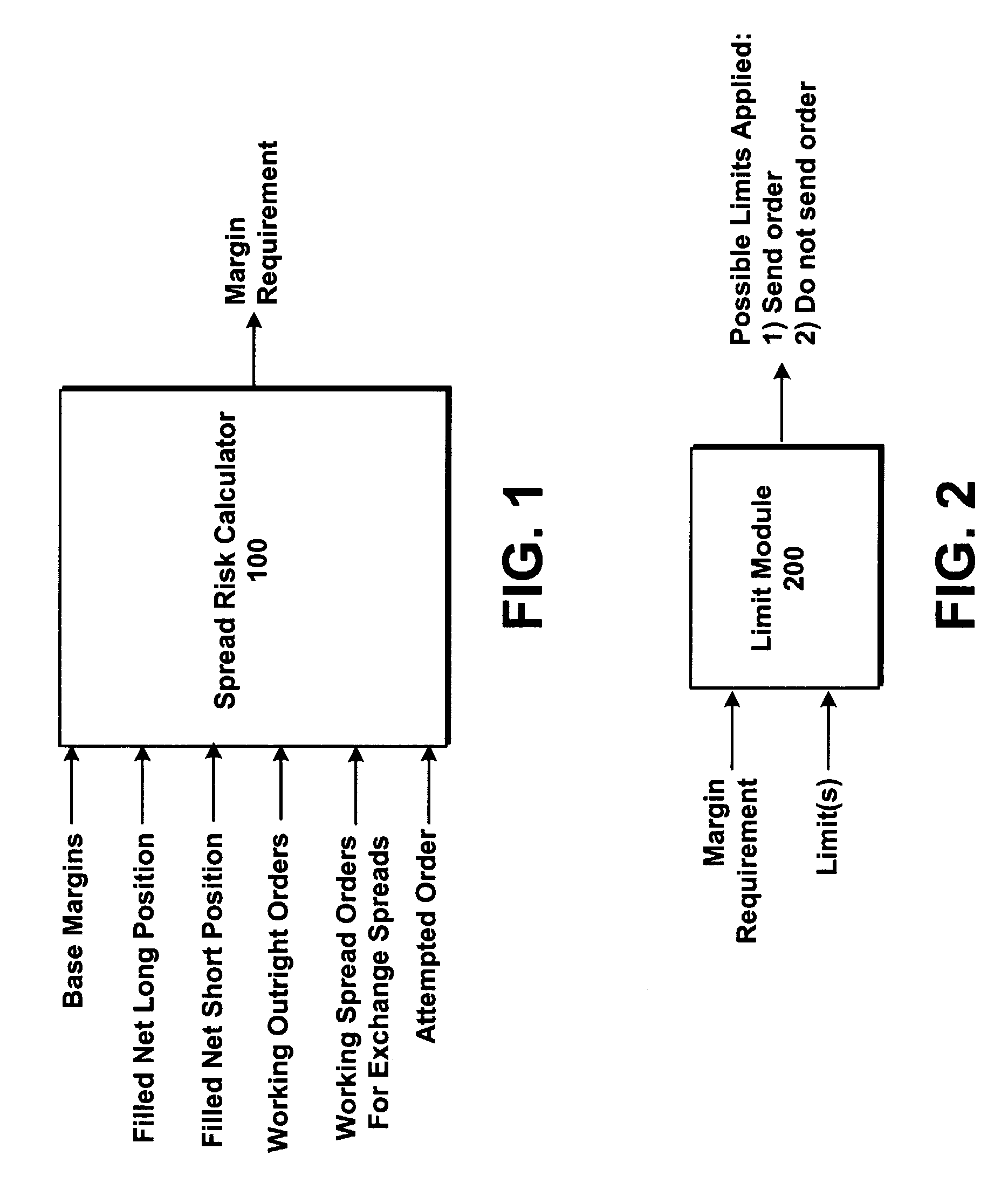

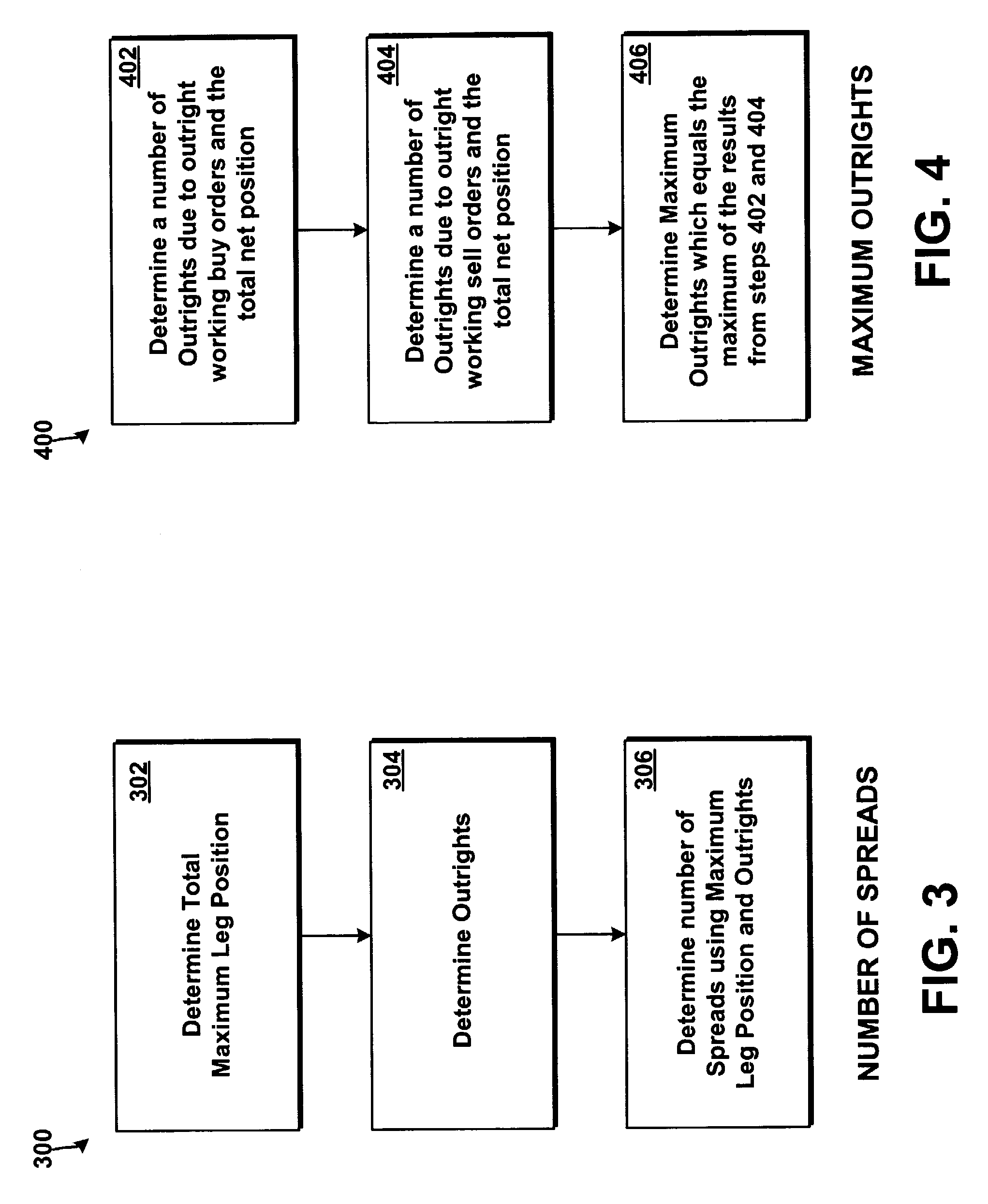

A margin requirement is computed while trading. The margin requirement may be calculated while trading because the preferred system takes into account working orders to generate the margin requirement. The on the fly possibility allows the preferred system to provide pre-trade risk calculations, but can also be used to provide post-trade calculations. A generic spread number and the maximum number of outright positions are determined. Using the spread positions and the maximum number of outright positions, a spread margin and an outright margin are calculated, which when summed provide a total margin requirement. Limits based in part on the total margin requirement may be imposed on one or more traders.

Owner:TRADING TECH INT INC

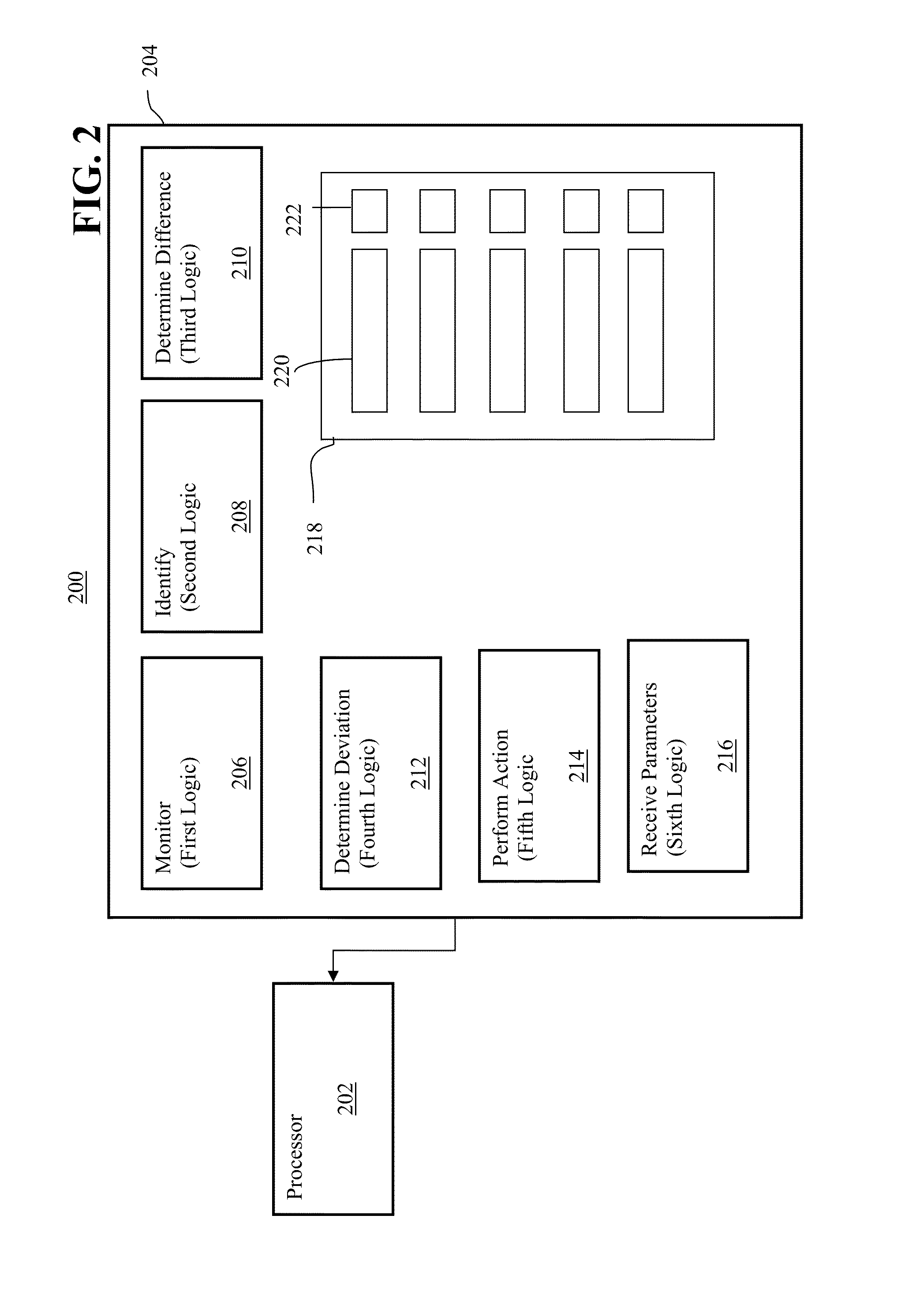

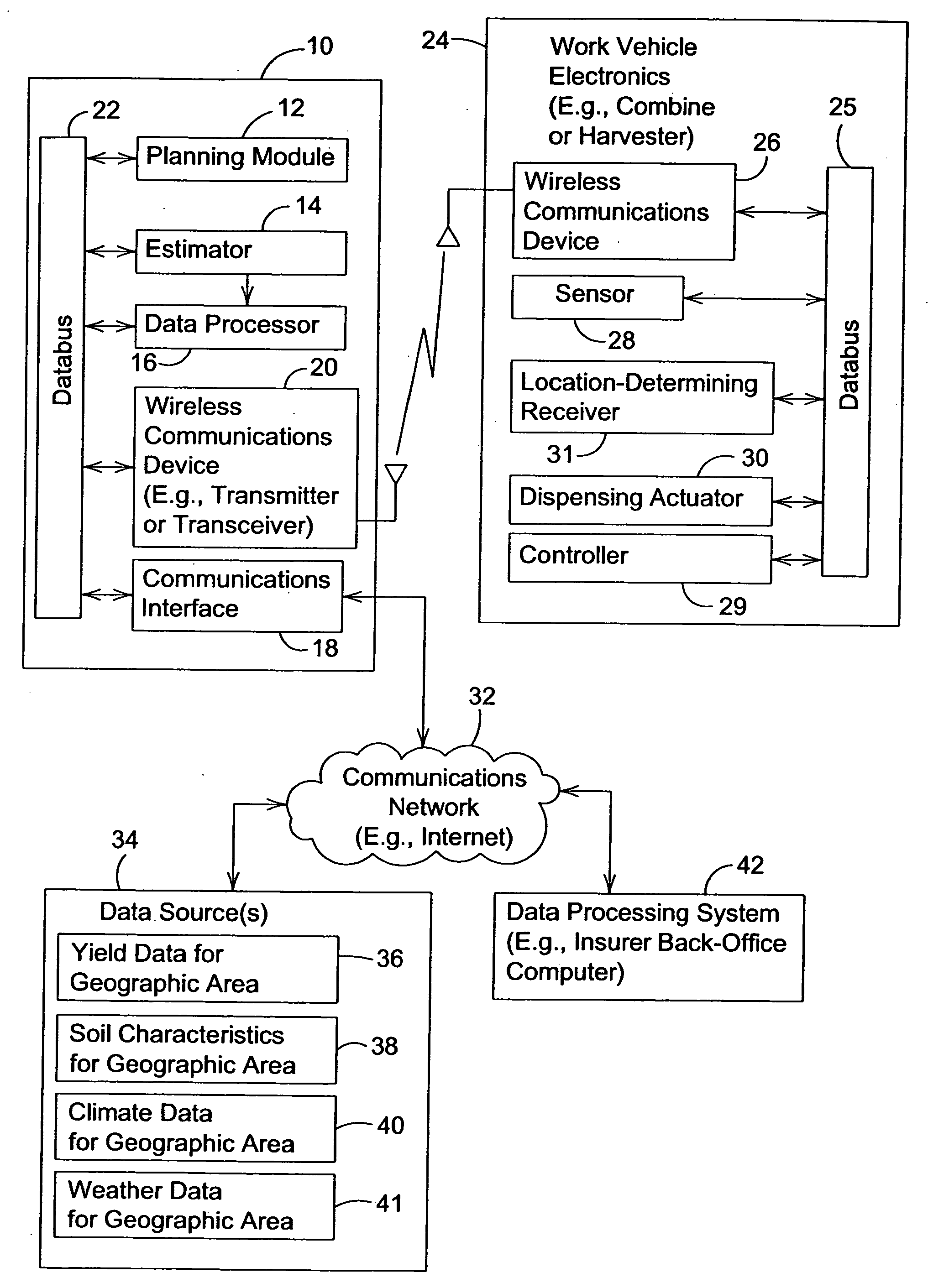

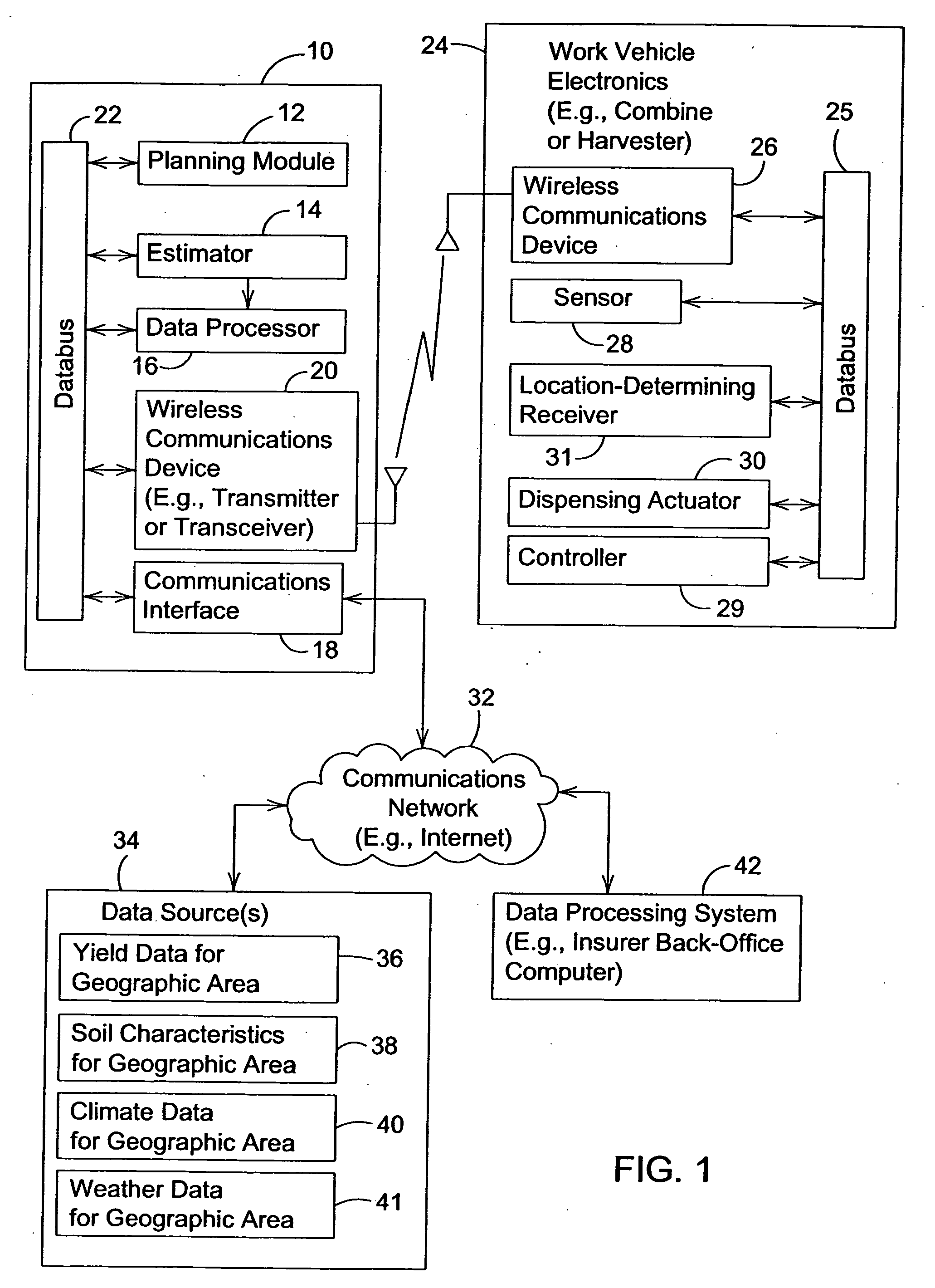

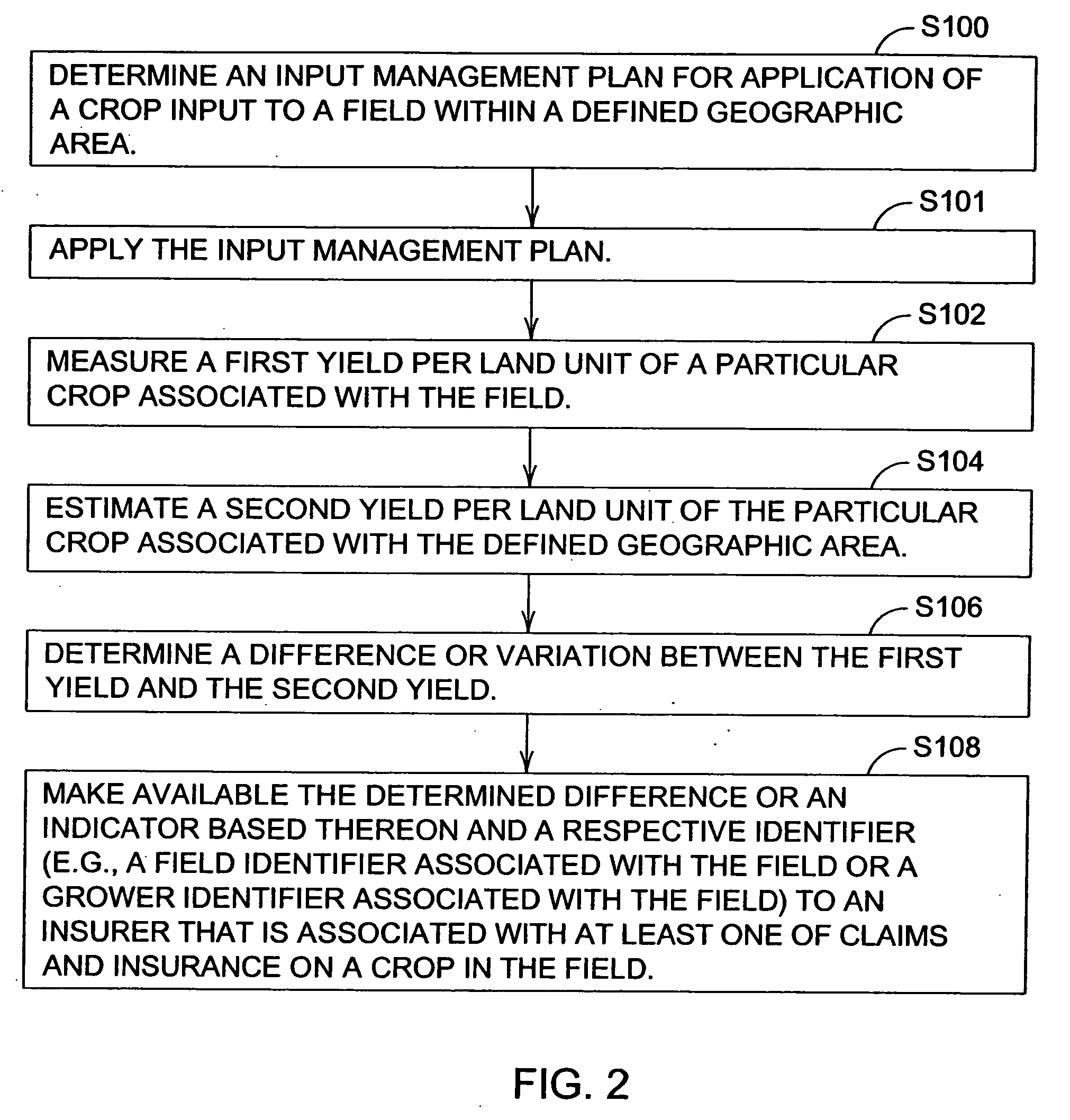

Risk management on the application of crop inputs

A system and method for managing a crop insurance program facilitates determining an input management plan for application of a crop input to a field within a defined geographic area. A field yield is measured. The field yield pertains to a yield of particular crop associated with a field in a defined geographic area. An aggregate yield is estimated. The aggregate yield relates to the particular crop associated with the defined geographic area. The aggregate yield is scaled to represent a generally equivalent land area to the field. A difference or variation is determined between the field yield and the aggregate yield. The determined difference or indication thereof is made available to a receiving entity (e.g., insurer that is associated with at least one of claims and insurance on the crop in the field).

Owner:FMH AG RISK INSURANCE

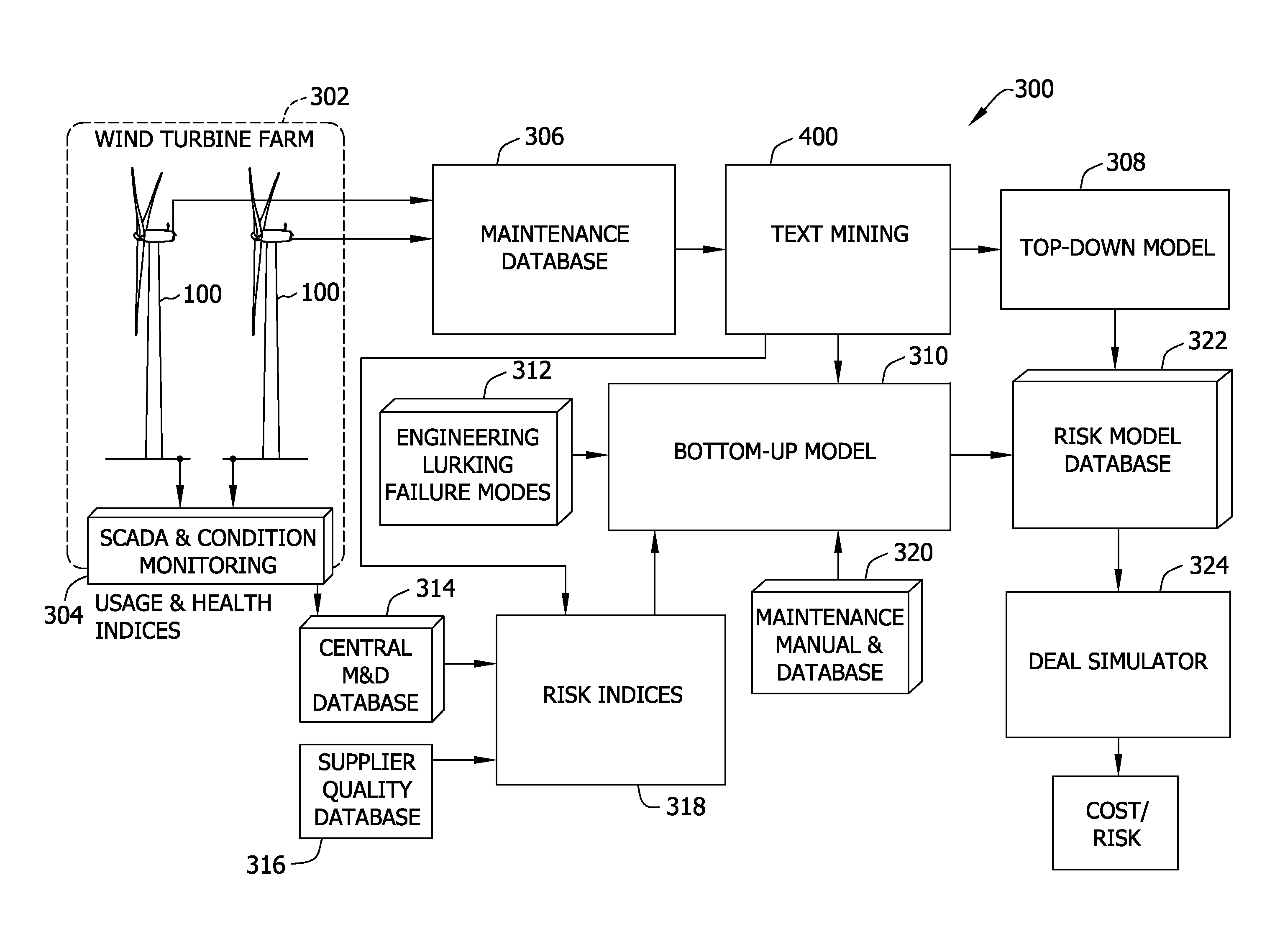

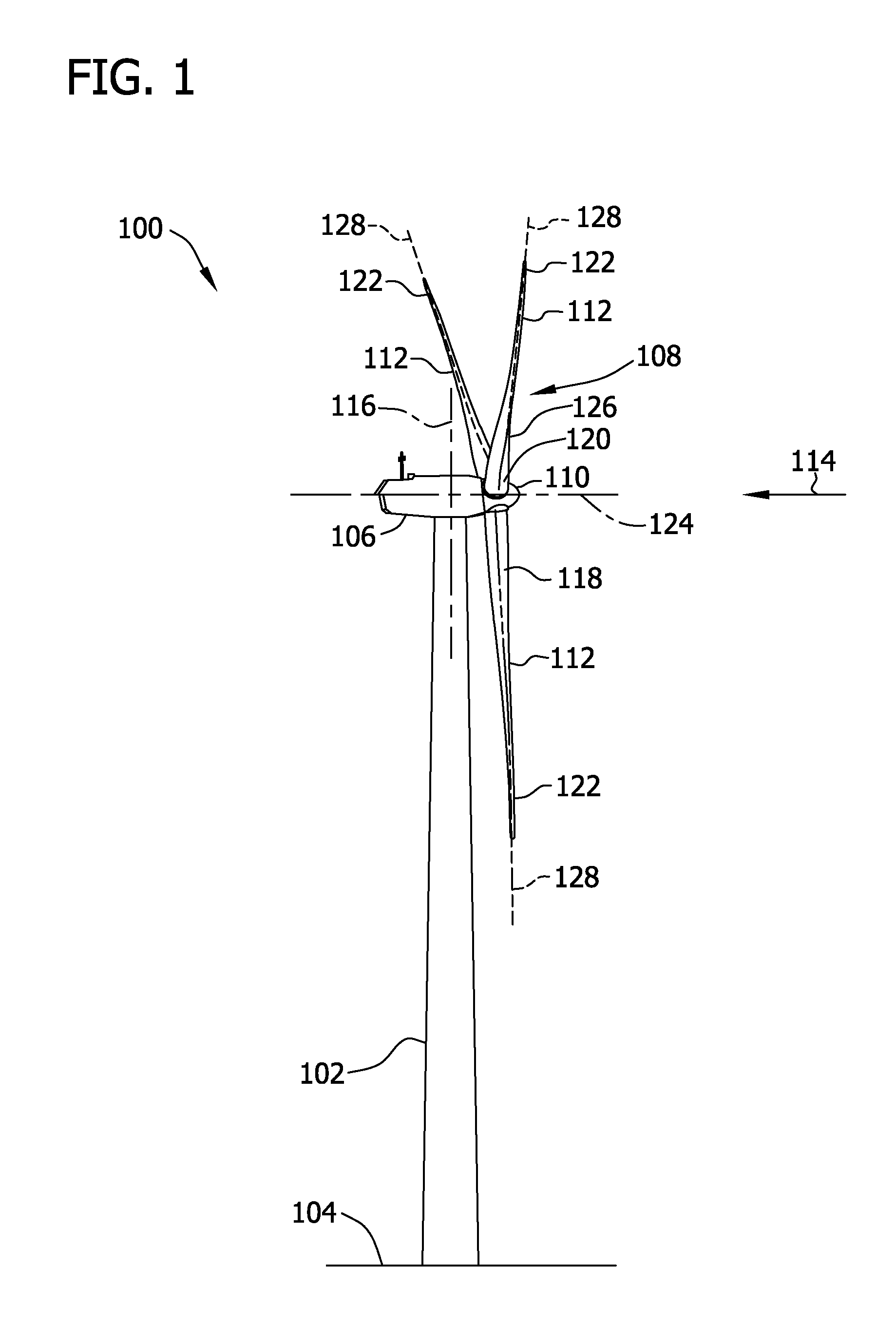

Risk management system for use with service agreements

A system for use with a risk management system is provided. The system includes a memory device configured to store data including at least historical service records of at least one wind turbine and new service records of the at least one wind turbine and a processor unit coupled to the memory device. The processor unit includes a programmable hardware component that is programmed. The processor unit is configured to analyze, by a processing system, text of the historical service records to generate a prediction model including a plurality of failure categories; and analyze, by a monitoring system, text of the new service records to classify each new service record based on the prediction model.

Owner:GENERAL ELECTRIC CO

System and method for risk management

A margin requirement is computed while trading. The margin requirement may be calculated while trading because the preferred system takes into account working orders to generate the margin requirement. The on the fly possibility allows the preferred system to provide pre-trade risk calculations, but can also be used to provide post-trade calculations. A generic spread number and the maximum number of outright positions are determined. Using the spread positions and the maximum number of outright positions, a spread margin and an outright margin are calculated, which when summed provide a total margin requirement. Limits based in part on the total margin requirement may be imposed on one or more traders.

Owner:TRADING TECH INT INC

Integrated hazard risk management and mitigation system

ActiveUS9613523B2Reduce the risk of fireReduce riskProgramme controlComputer controlData processing systemIT risk management

A system for hazard mitigation in a structure including a subsystem coupled to a circuit of an electrical distribution system and set of nodes. The nodes monitor operating conditions of the circuit and generate data in response. A data processing system is operable to process the data generated by the set of nodes and in response identify a trigger representing a condition requiring that an action be taken. The data processing system processes the trigger in accordance with a predetermined policy to initiate an action by the subsystem.

Owner:UNILECTRIC LLC

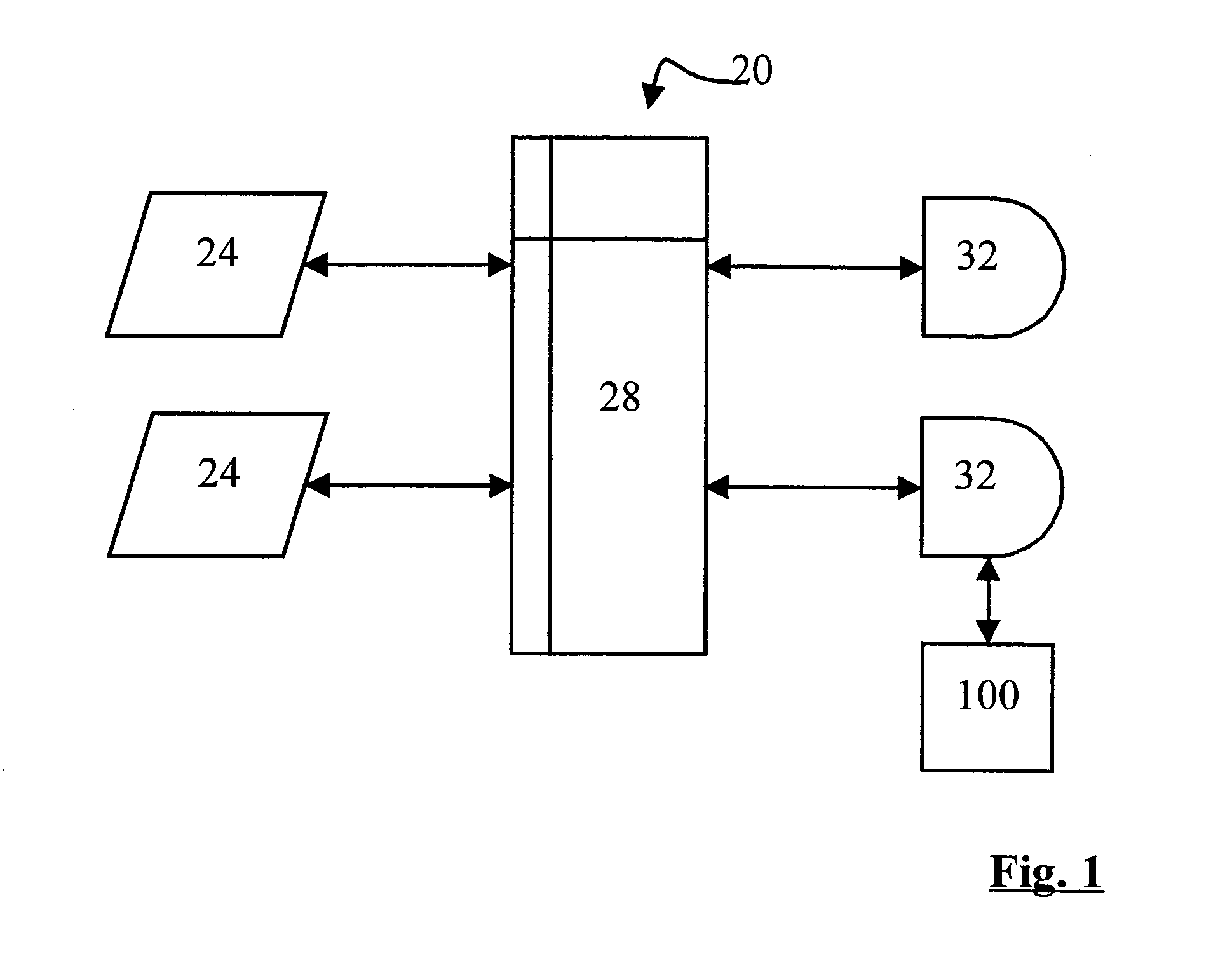

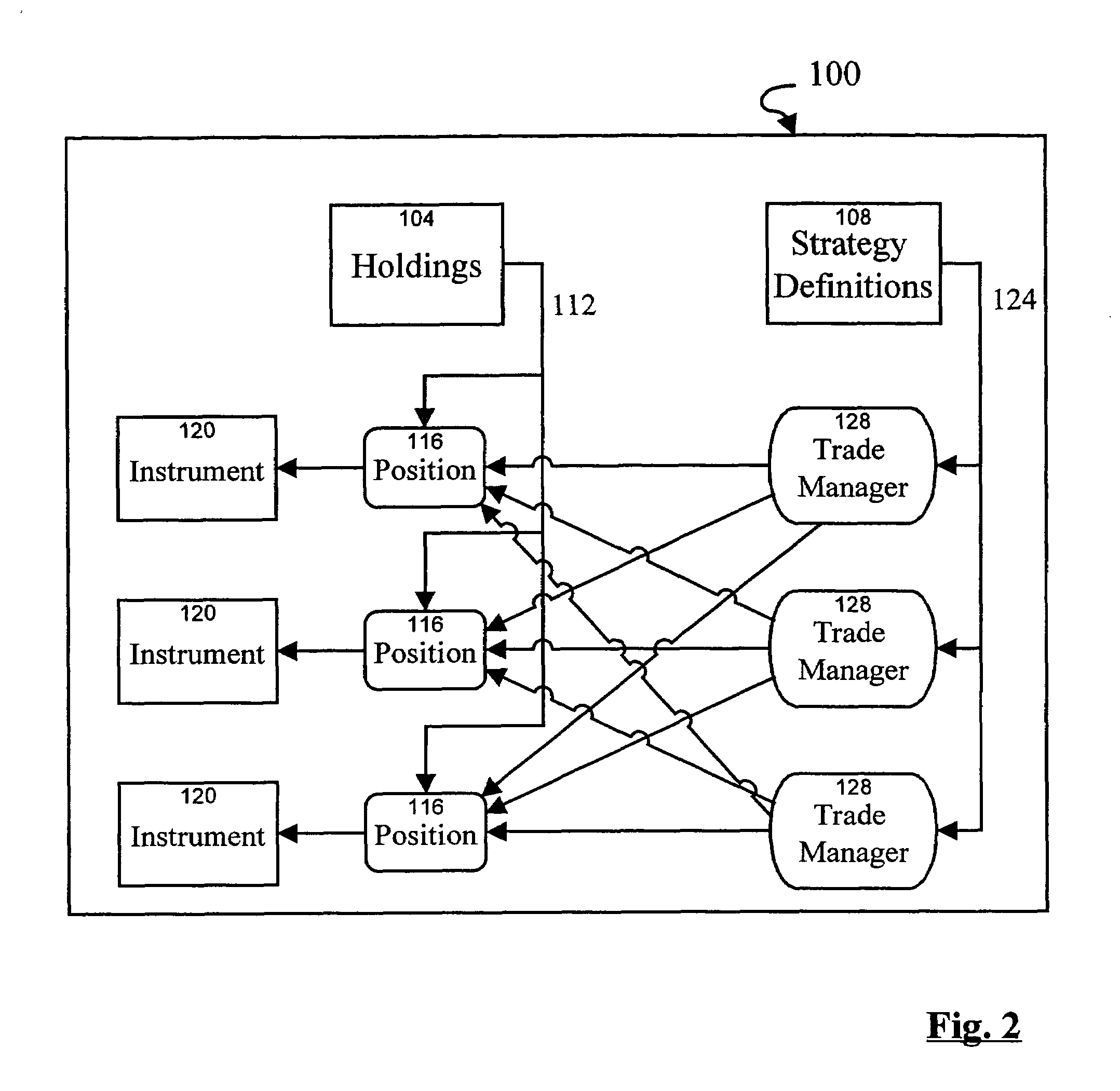

Risk management system and method providing rule-based evolution of a portfolio of instruments

A risk management system and method provides for the establishment of dynamic portfolios, whose evolution over time is defined by one or more rules. Each dynamic portfolio can have instruments added and removed over time in accordance with Trade Managers as a result of evaluation of the user-defined rules which can be dependent upon various attributes, including time, portfolio contents, risk factor values, risk values and other information. Such dynamic portfolios can be used to analyze risk associated with settlement, liquidity and / or collateral management issues, to name a few. Also, a user can define multiple candidate trading strategies, each implemented in one or more Trade Managers, and the user can then analyze the effectiveness of the candidate strategies, before adopting one.

Owner:IBM CORP

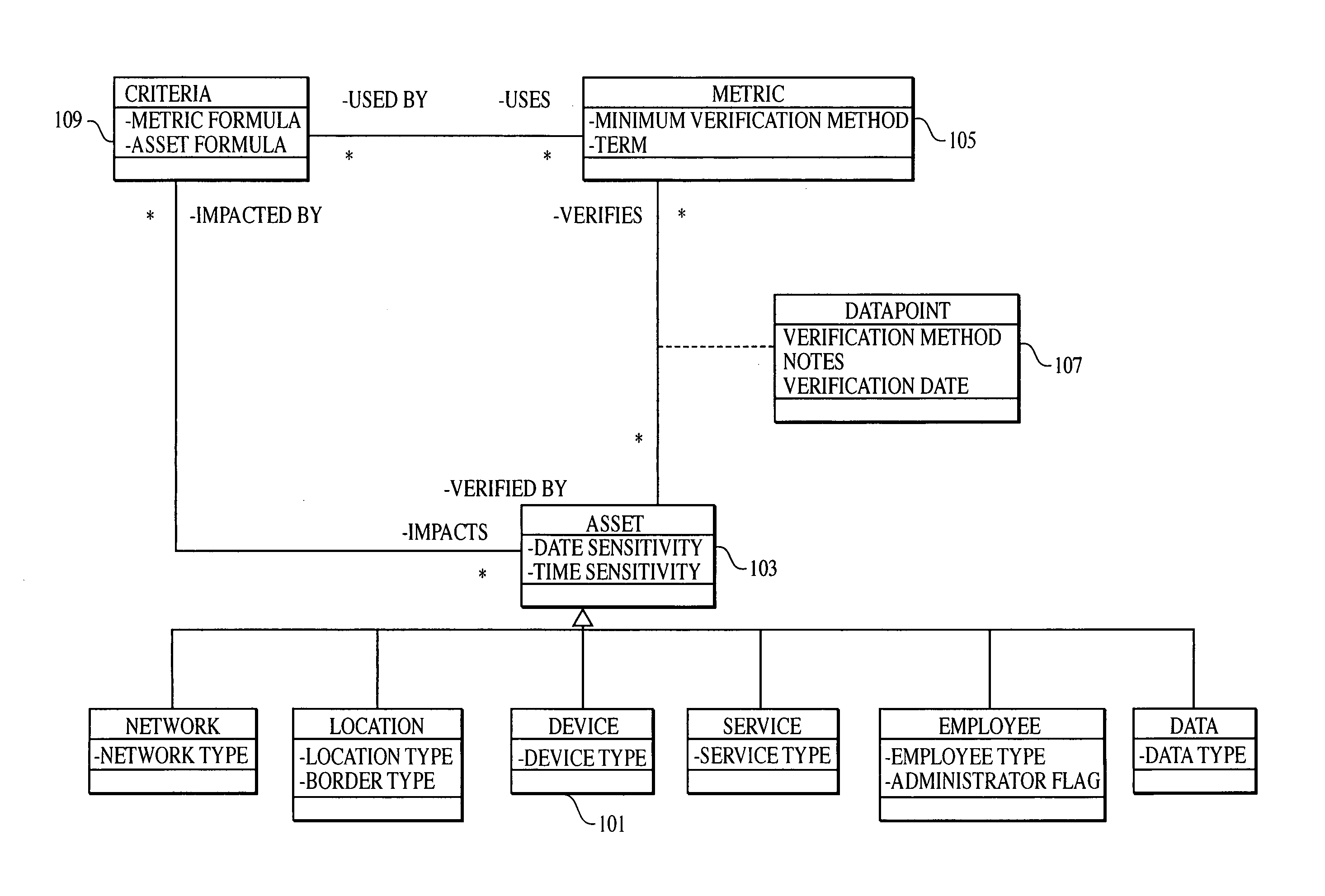

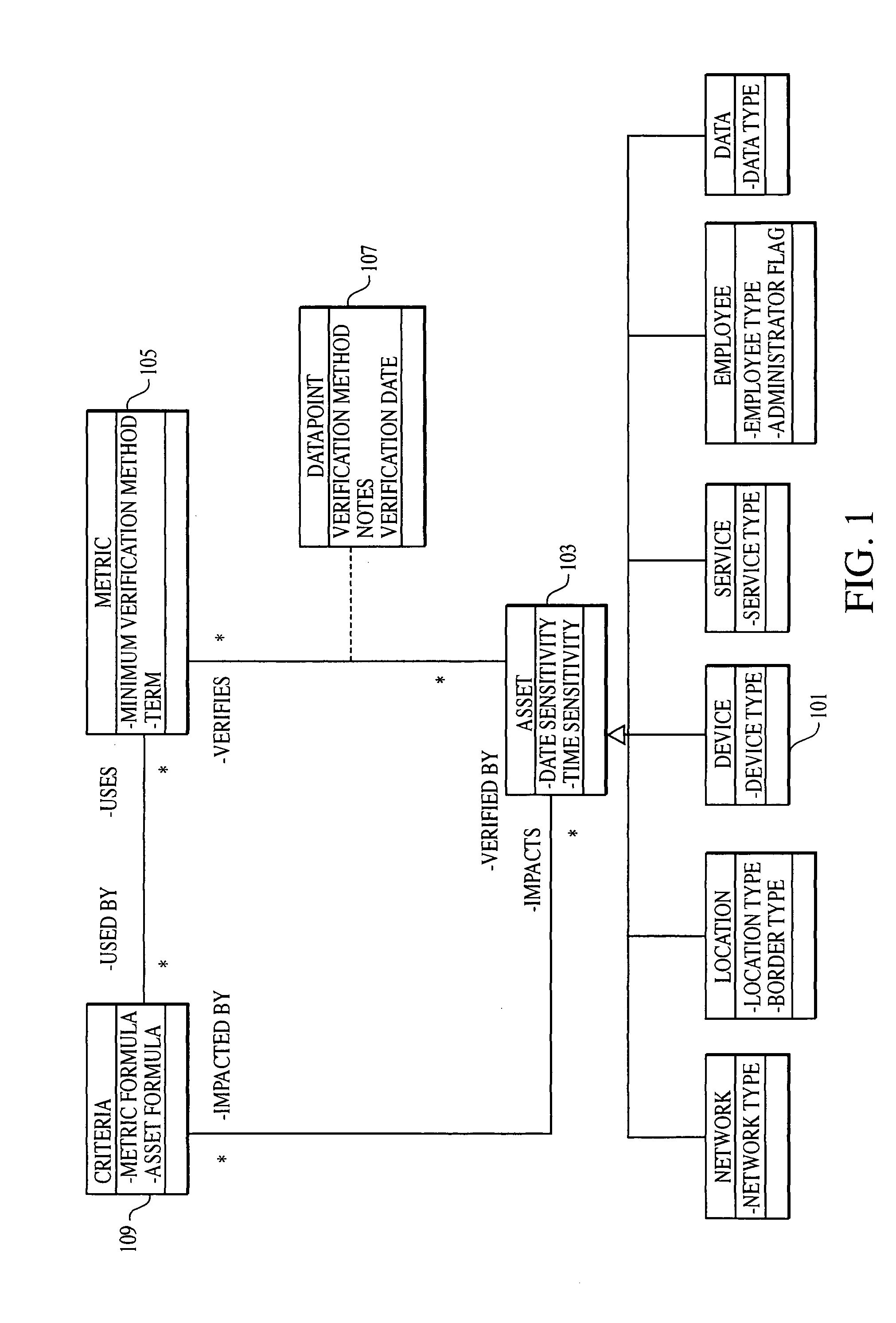

Object-oriented method, system and medium for risk management by creating inter-dependency between objects, criteria and metrics

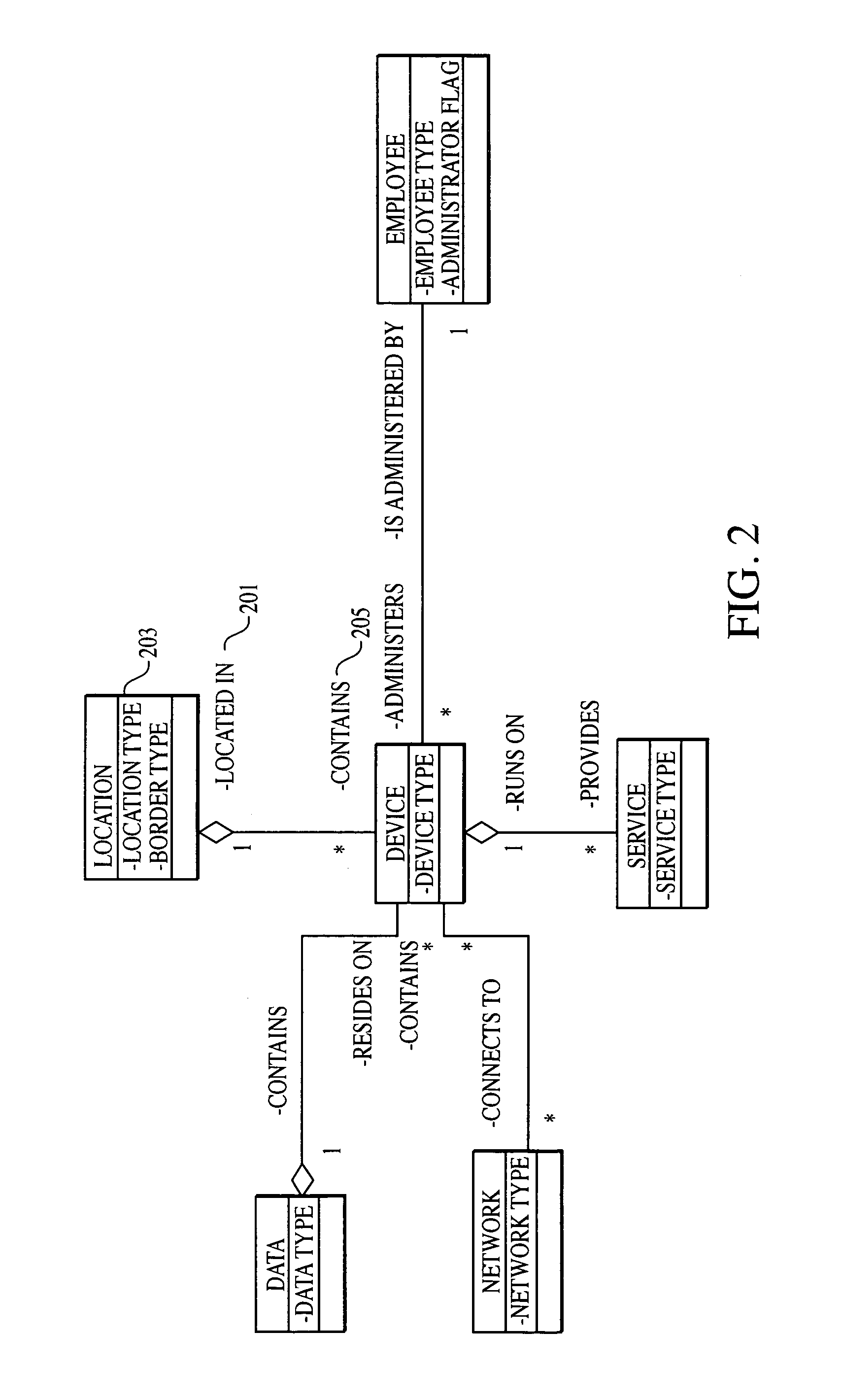

A method, system, and medium for assessing and / or managing risks for an organization is described. The method, for example, comprises the steps of inventorying a number of assets of the organization, identifying at least one criterion defining a security objective of the organization, and identifying one or more inventoried assets that relate to the identified criterion. The assets may include one or more computers, networking equipment therefor and physical locations where the computers and networking equipment are located. The method may also include the step of formulating one or more metric equations, each metric equation being defined, in part, by the one or more identified assets. Each metric equation yields an outcome value when one or more measurements are made relating to the identified assets. The method may also include the step of assessing the risk to the organization based on the measured values of the one or more metric equations. Corresponding system, medium and means are also described.

Owner:VERIZON PATENT & LICENSING INC

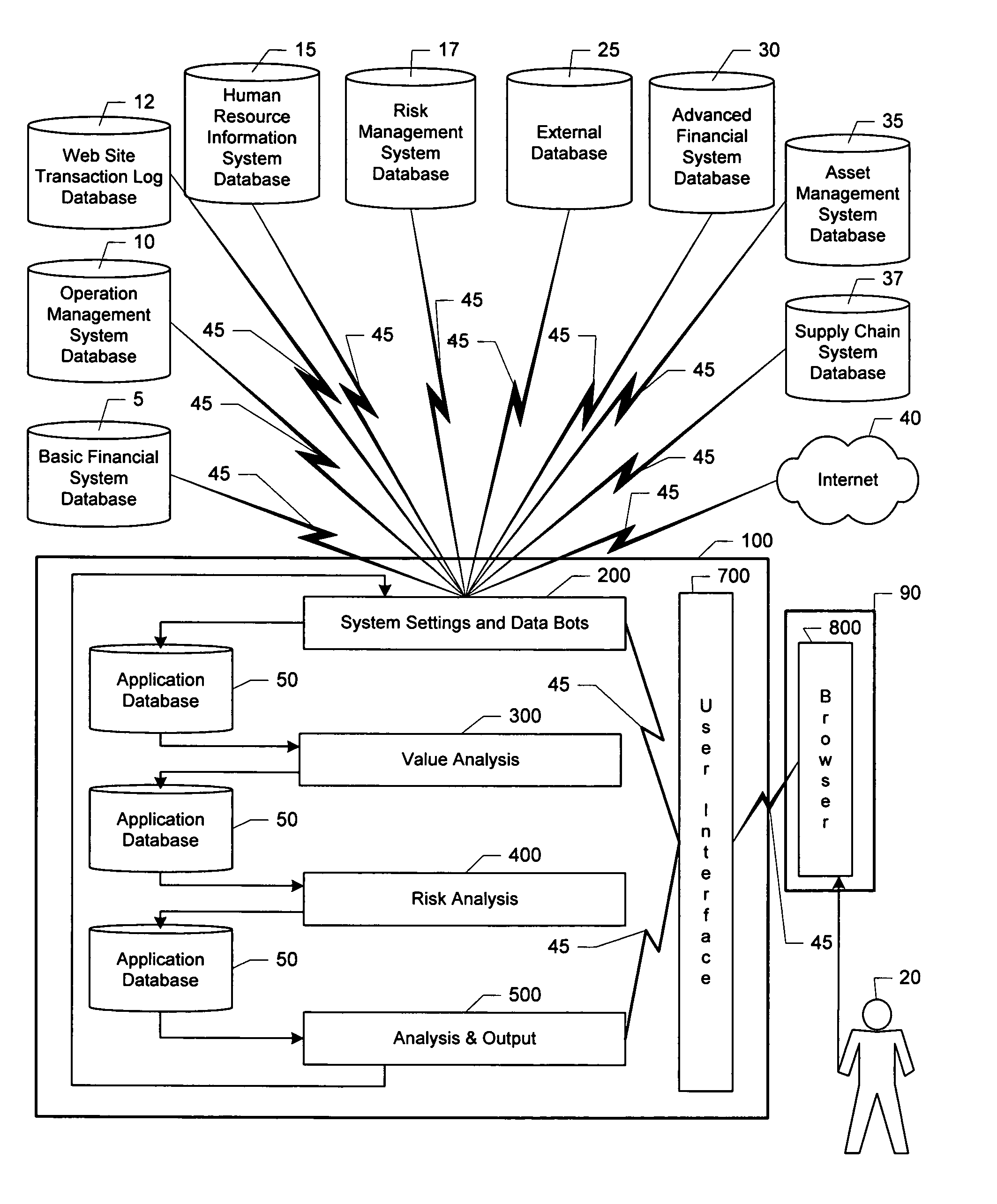

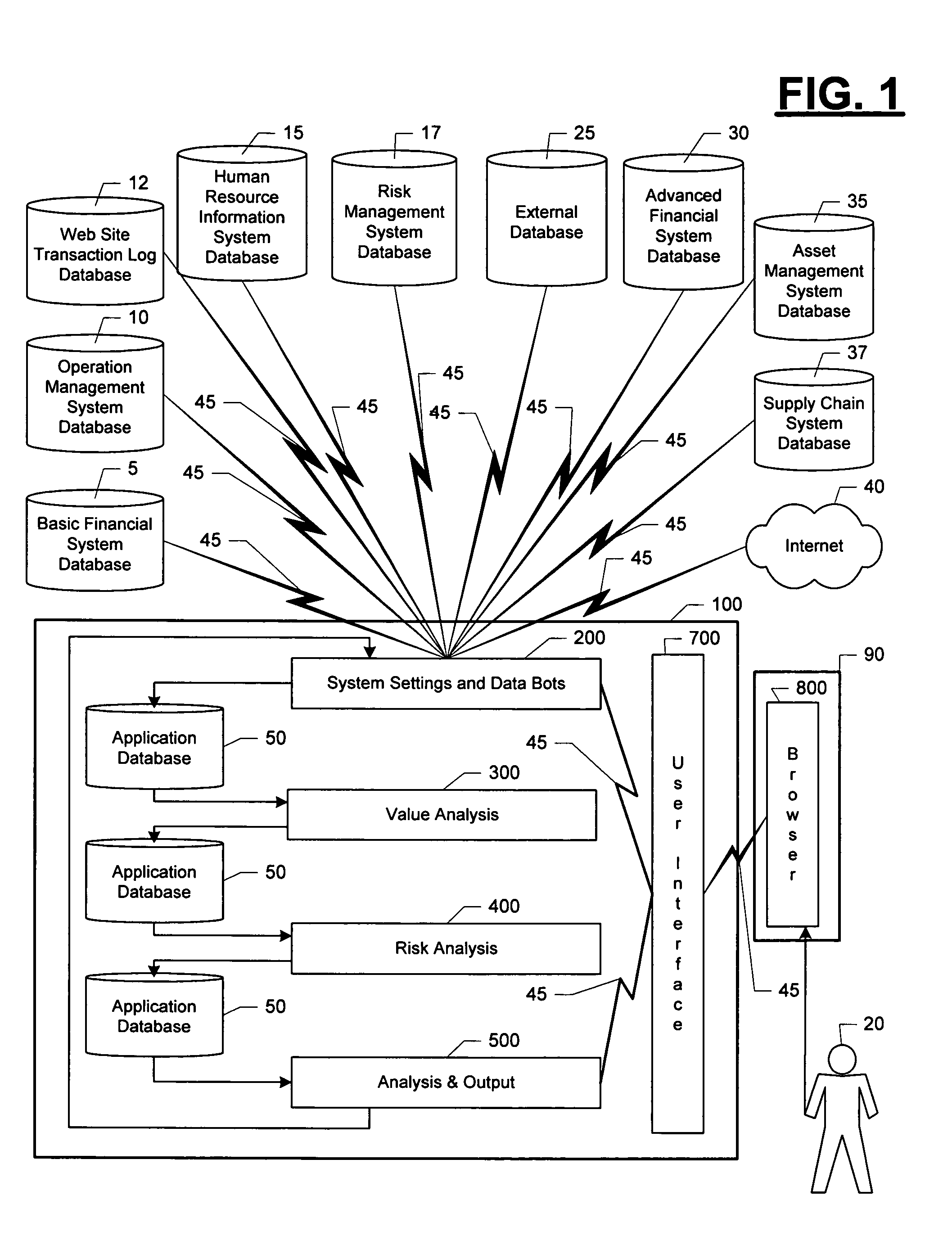

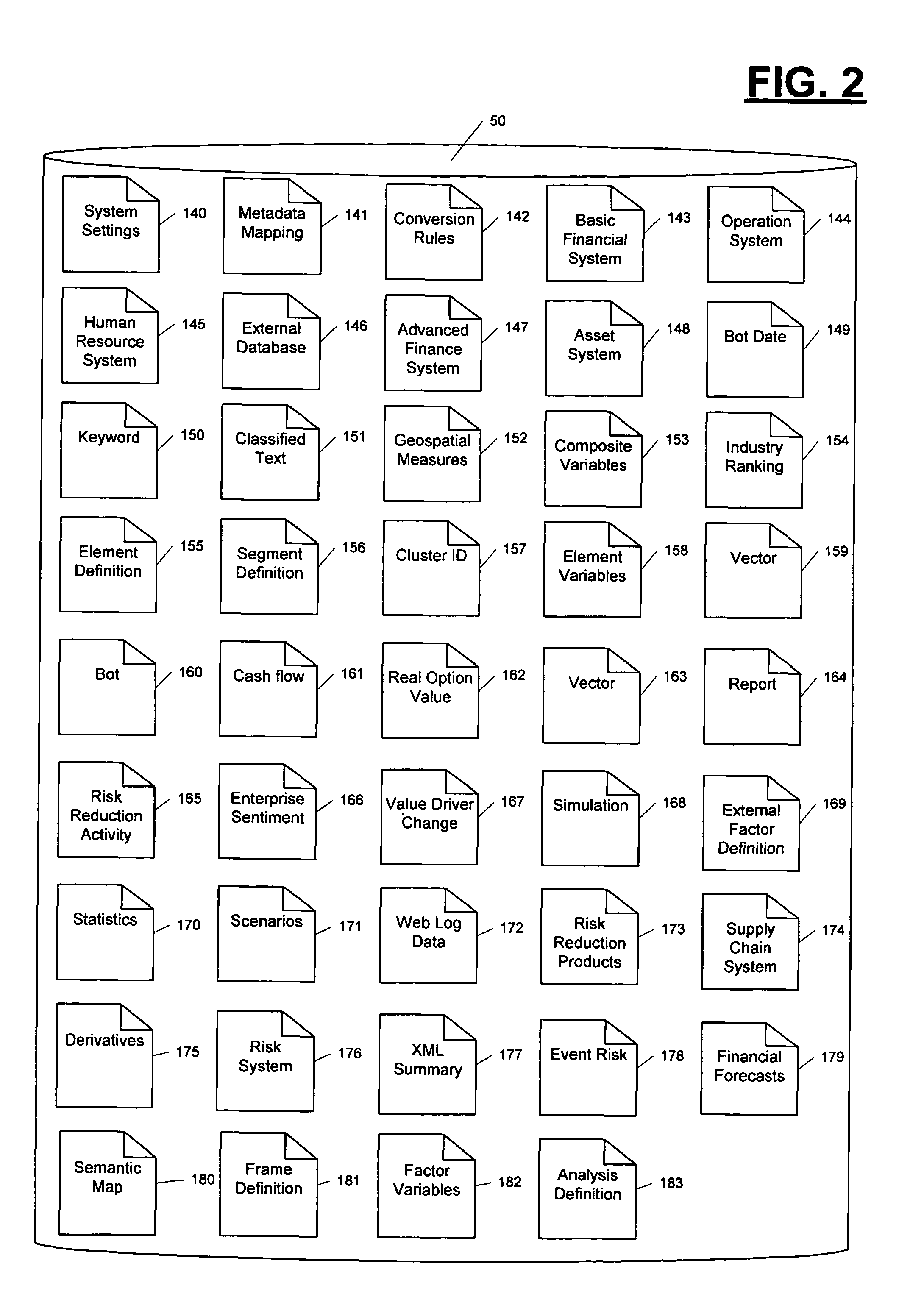

Value and risk management system

InactiveUS7873567B2Increases scale and scopeEnhances efficiency and effectivenessFinanceIT risk managementComputer science

Owner:EDER JEFFREY

A risk management system for securities

A method and system (100) for identifying, measuring and managing the risk associated with a portfolio of securities.

Owner:ASSET RELIANCE INC

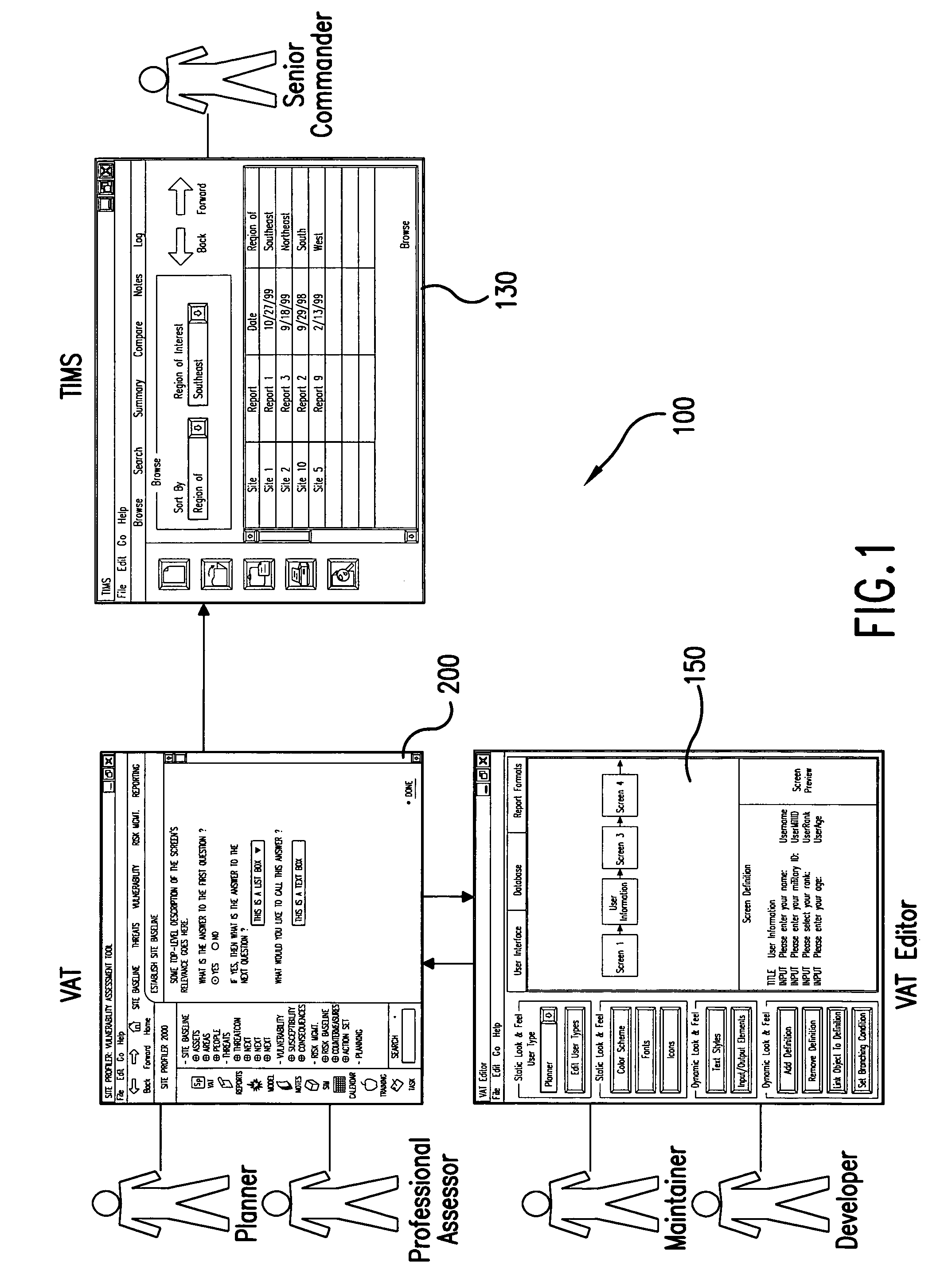

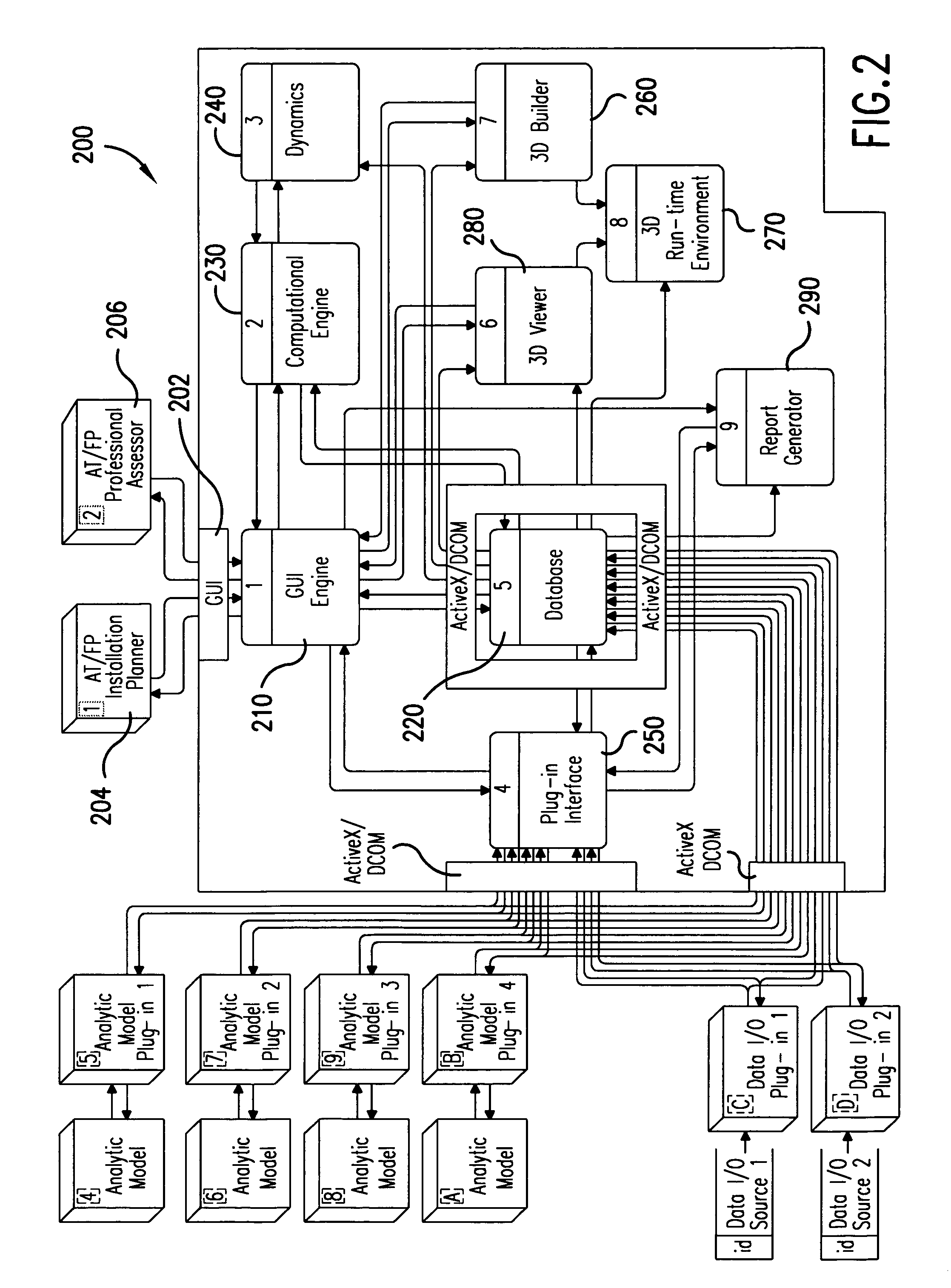

Method and apparatus for risk management

InactiveUS7231327B1Quickly and easily buildDetermine effectivenessFinanceComputation using non-denominational number representationIT risk managementPersistent object

An integrated risk management tool includes a persistent object database to store information about actors (individuals and / or groups), physical surroundings, historical events and other information. The risk management tool also includes a decision support system that uses data objects from the database and advanced decision theory techniques, such as Bayesian Networks, to infer the relative risk of an undesirable event. As part of the relative risk calculation, the tool uses a simulation and gaming environment in which artificially intelligent actors interact with the environment to determine susceptibility to the undesired event. Preferred embodiments of the tool also include an open “plug-in” architecture that allows the tool to interface with existing consequence calculators. The tool also provides facilities for presenting data in a user-friendly manner as well as report generation facilities.

Owner:DIGITAL SANDBOX

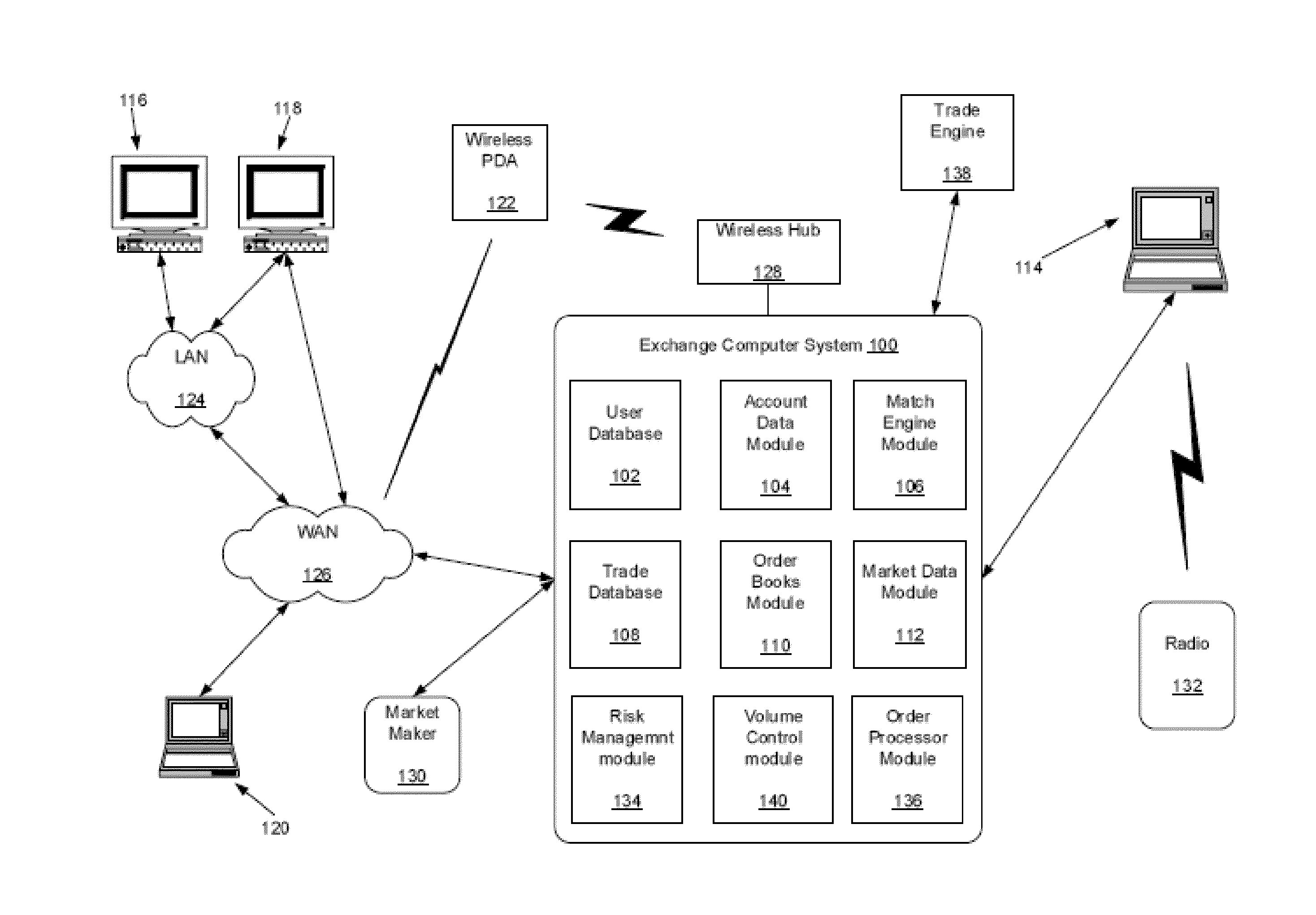

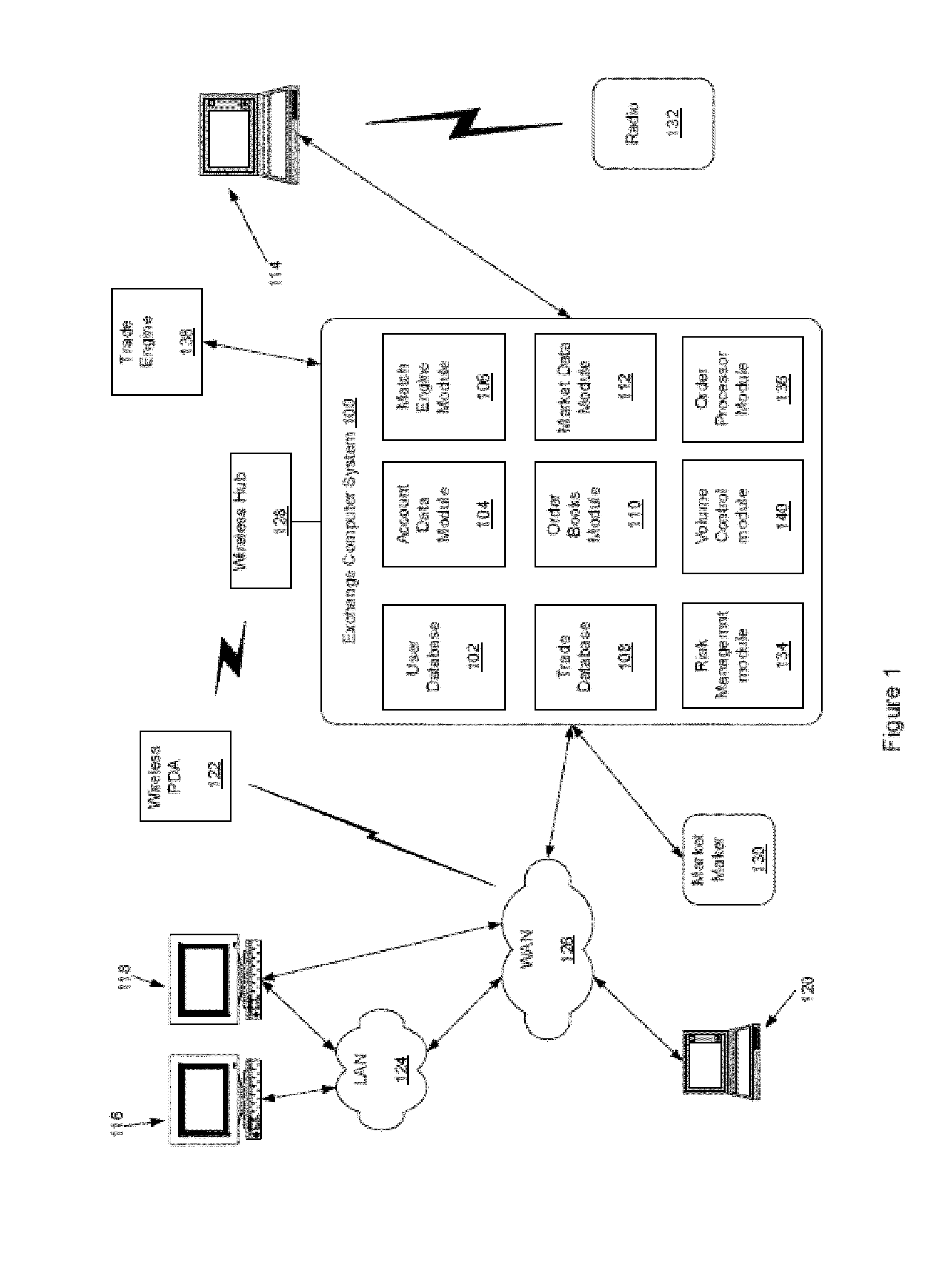

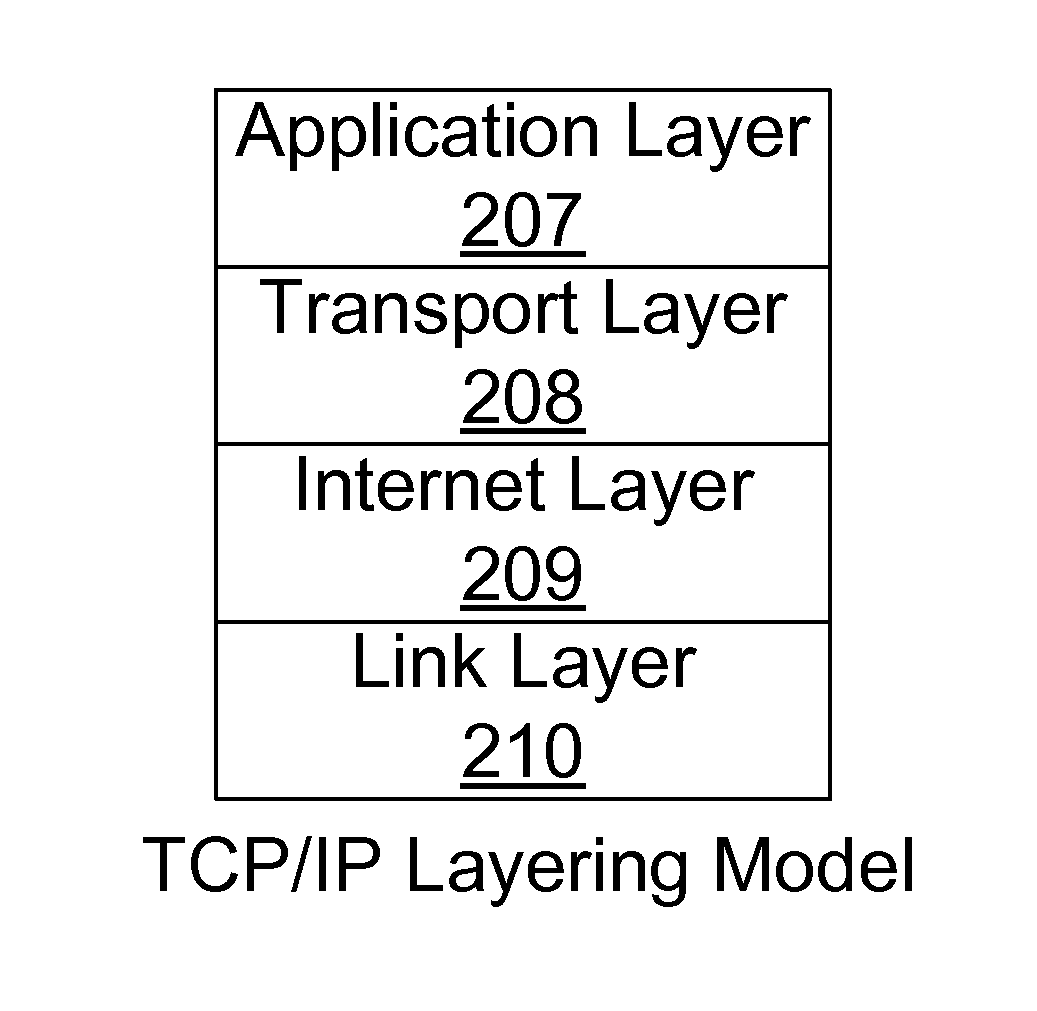

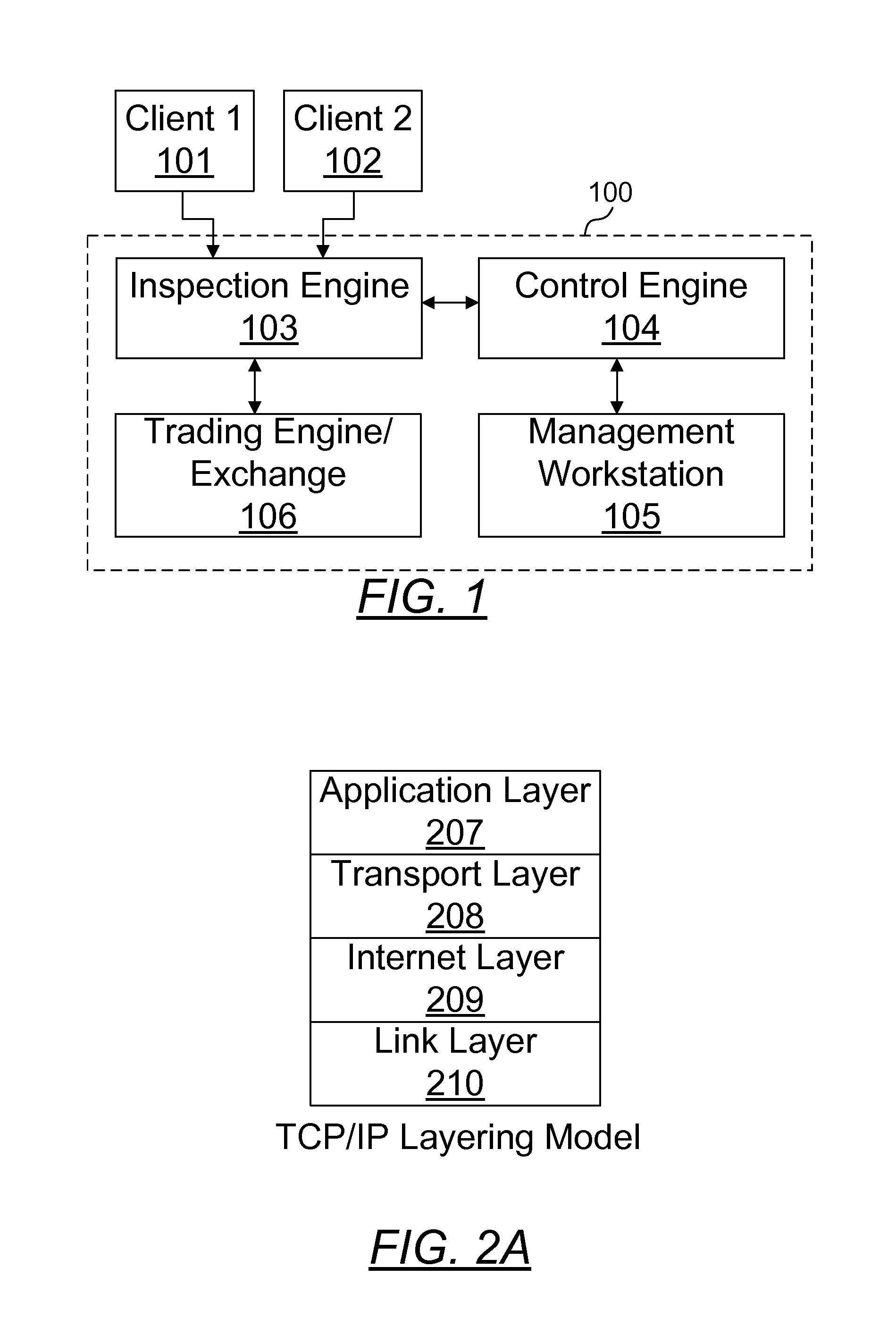

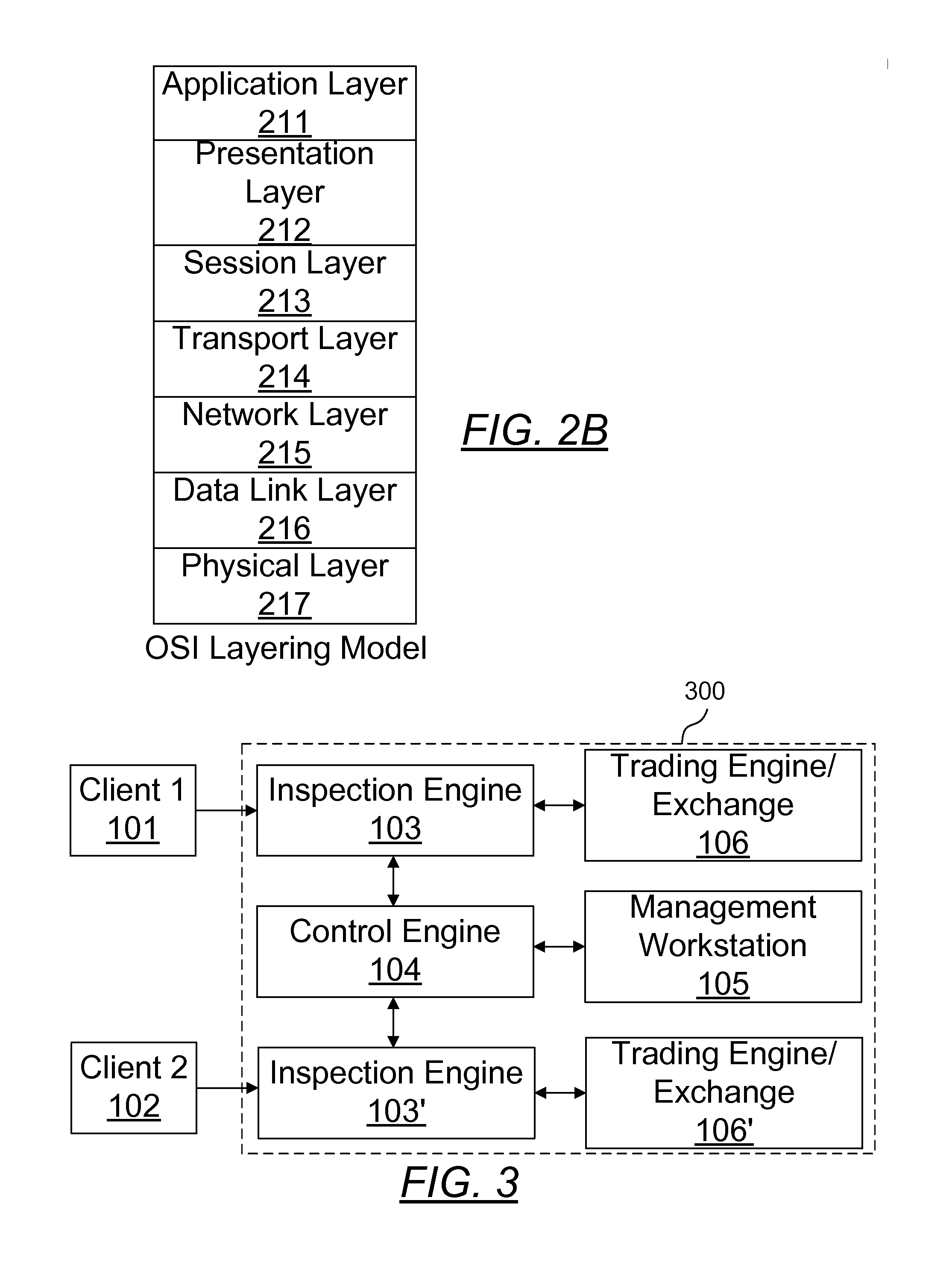

Risk management system and method for monitoring and controlling of messages in a trading system

InactiveUS20150332398A1Optimizes risk factorDelay minimizationFinanceIT risk managementElectronic trading

Methods and systems are disclosed for risk management in electronic trading where user messages are collected by at least one inspection engine which monitors one or more parameters of the user messages. The decision to manipulate the user messages is based on whether one or more of the parameters or a risk factor exceeds a predetermined range limit. The user messages are then transmitted to a trading engine where the user messages with manipulated parameters are rejected and the user messages with unchanged parameters are processed normally. By eliminating the need to maintain state with the message protocol of the user messages, the transport speed of such user messages is improved.

Owner:BRKIC SLAV +1

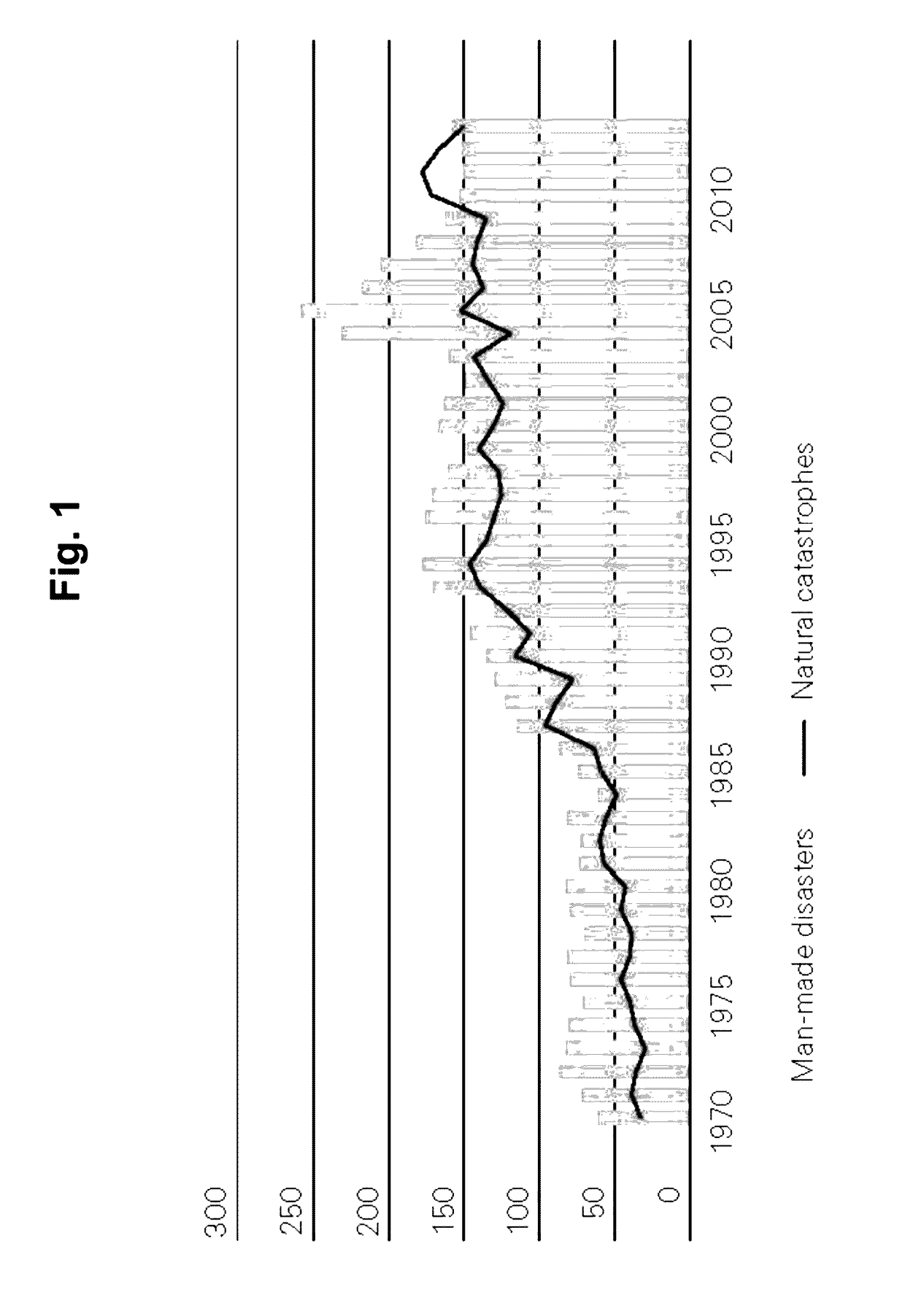

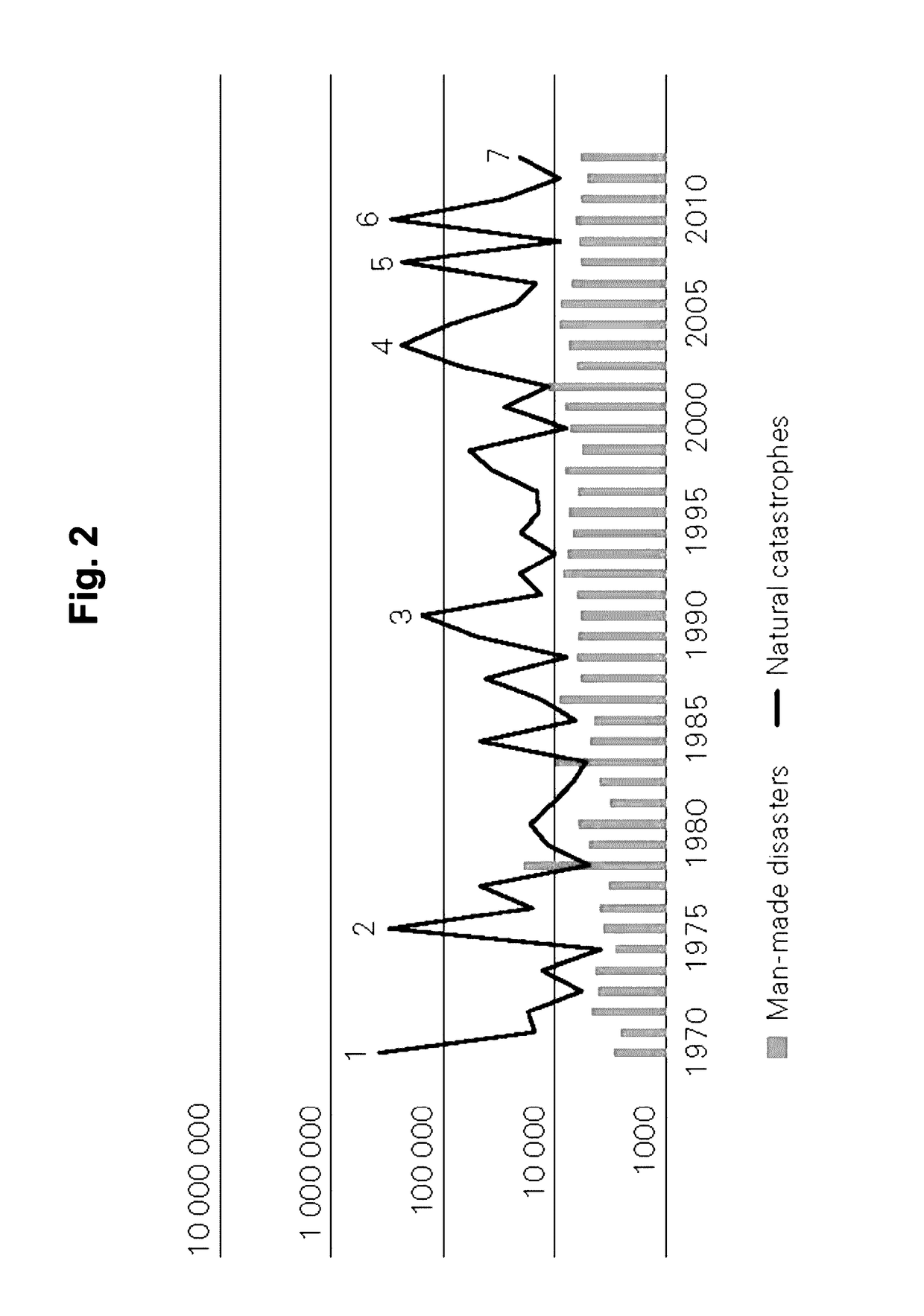

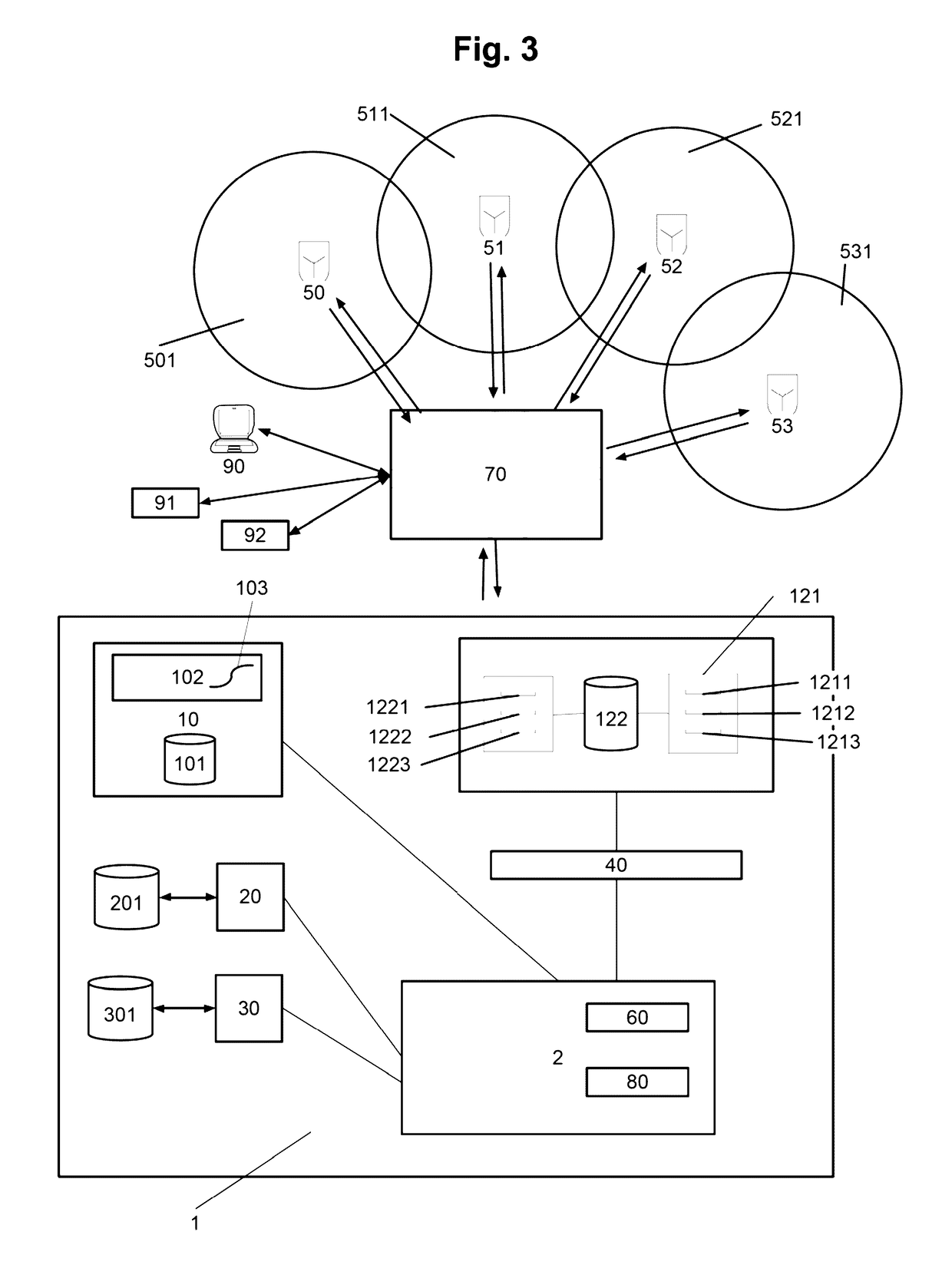

Disaster risk management and financing system, and corresponding method thereof

ActiveUS20170161859A1Improve risk profileEasy to understandFinanceResourcesIT risk managementNatural disaster

A method and system, the method including capturing country-specific parameters of a risk-exposed country relating to stored predefined criteria, assigning one or more disaster event types to a disaster history table, capturing and storing mapping parameters for a geographic risk map, assigning each of a plurality of selectable disaster financing types to a definable cost factor capturing the capital cost of the disaster financing type in relation to its application for disaster mitigation, determining expected catastrophe losses by a loss frequency function and the geographic risk map for various scenarios of occurring natural disaster event types, and preparing a forecast of an effect of the disaster financing type to cover the catastrophe losses based on the coverage structure, the assigned cost factors, and the determined expected catastrophe losses

Owner:SWISS REINSURANCE CO LTD

Flight risk management system

A Flight Risk Management System (“FRMS”). The system provides supplementary preflight and in-flight guidance to relatively inexperienced owner / operators of high performance aircraft. A pilot wishing to enroll in the FRMS must have an aircraft equipped with an in-flight data recorder capable of monitoring the aircraft's state and communicating this state to an FRMS dispatcher. The dispatcher analyzes each flight before its commencement and imposes restrictions designed to promote flight safety. The dispatcher monitors the flight in progress to ensure the pilot's compliance with all directives. For most enrollees, participation in the FRMS is a mandatory condition precedent to the pilot's insurance coverage. Thus, the potential loss of insurance coverage enforces compliance. In the preferred embodiment, the FRMS manages pilot training, pilot performance, aircraft maintenance, and flight risk assessment.

Owner:NEMETH LOUIS GEZA

System and method for risk management using average expiration times

A margin requirement is computed while trading. The margin requirement may be calculated while trading because the preferred system takes into account working orders to generate the margin requirement. The on the fly possibility allows the preferred system to provide pre-trade risk calculations, but can also be used to provide post-trade calculations. A generic spread number and the maximum number of outright positions are determined. Average expirations for the generic spread are computed. Using the spread positions, the average expirations and the maximum number of outright positions, a spread margin and an outright margin are calculated, which when summed provide a total margin requirement. Limits based in part on the total margin requirement may be imposed on one or more traders.

Owner:TRADING TECH INT INC

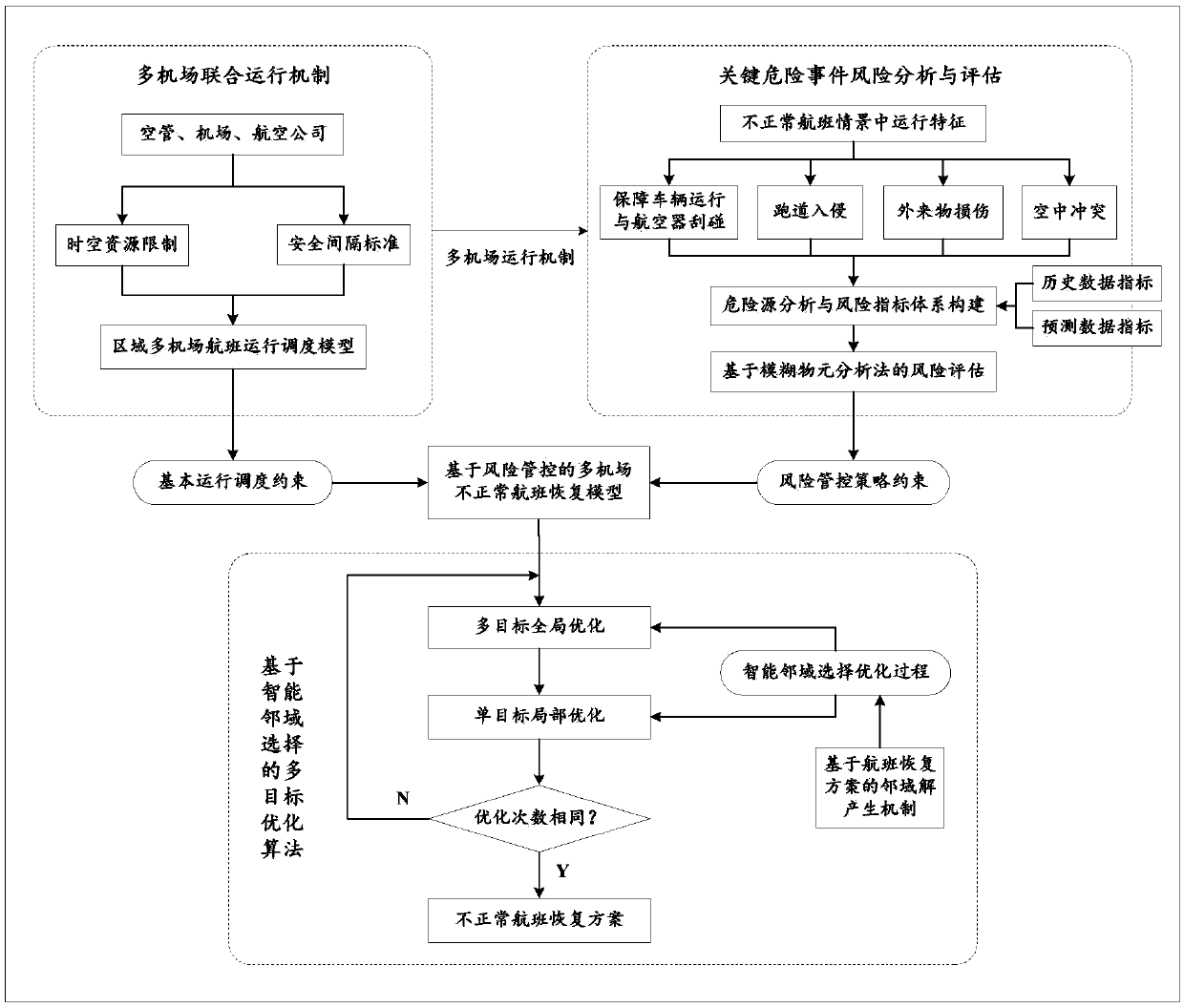

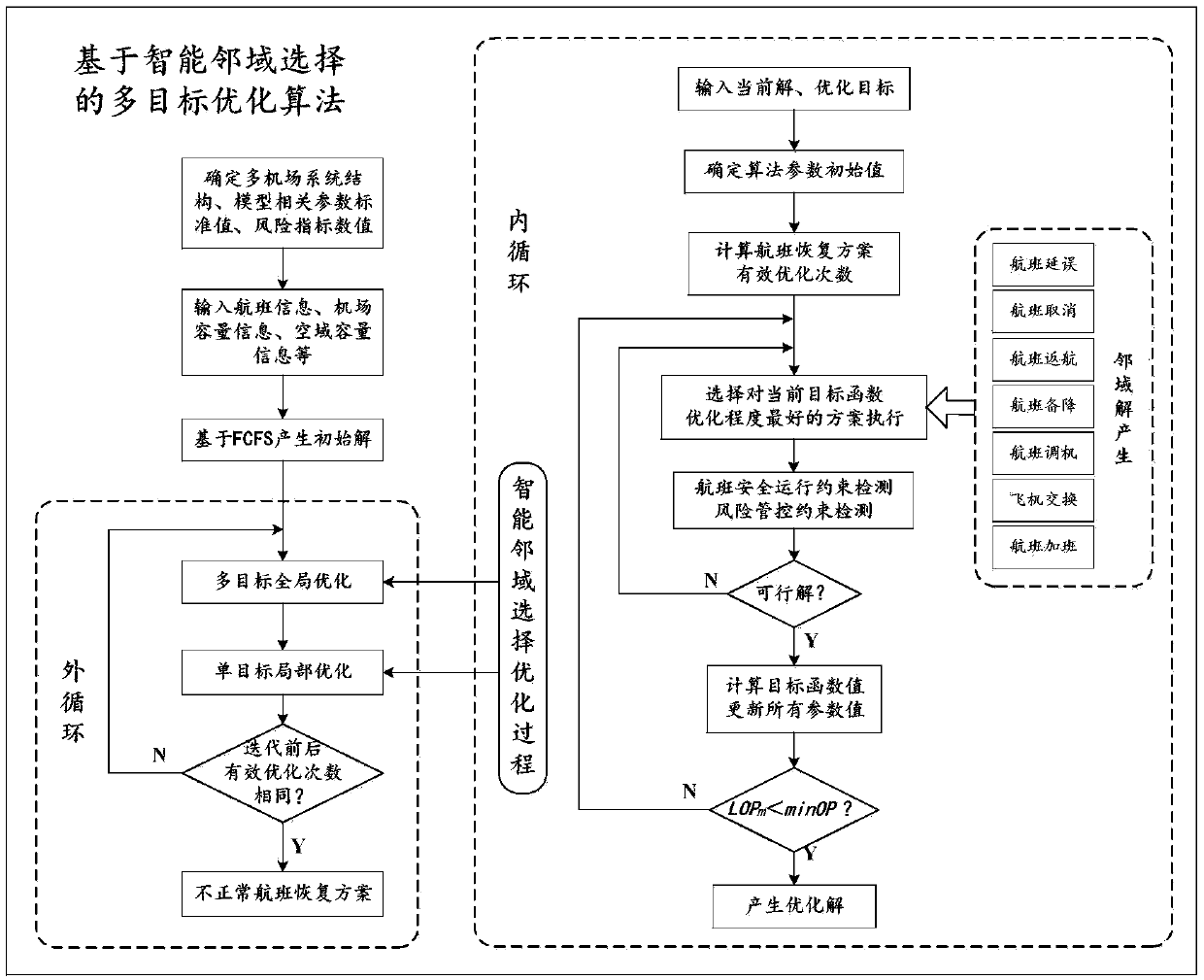

Regional multi-airport abnormal flight recovery method based on risk management and control

ActiveCN108985621AEffective recoveryMulti-objective optimization is fastResourcesMulti objective optimization algorithmRecovery method

The invention discloses a regional multi-airport abnormal flight recovery method based on risk management and control. The method includes: firstly, a regional multi-airport flight scheduling model isconstructed, secondly, the fuzzy analytic hierarchy process is used to quantitatively evaluate the risk value of relevant dangerous events in each unit, finally, a regional multi-airport abnormal flight restoration model based on risk management and control is constructed, and the actual flight restoration method is applied to the algorithm neighborhood solution generation mechanism according tothe characteristics of the model, and a multi-objective optimization algorithm based on intelligent neighborhood selection is designed to solve the model. The invention can be applied to the problem of abnormal flight restoration of regional multi-airports. Through consideration of the resource constraint of regional multi-airport system coupling, the potential safety risks of the key dangerous events in the abnormal flight-induced system is controlled in a targeted manner and the flight recovery plan of the regional multi-airport system is coordinated from the overall perspective, so that theabnormal flight recovery plan of the regional multi-airport system has higher safety and maneuverability. The method has a broad promotion and application prospect.

Owner:NANJING UNIV OF AERONAUTICS & ASTRONAUTICS

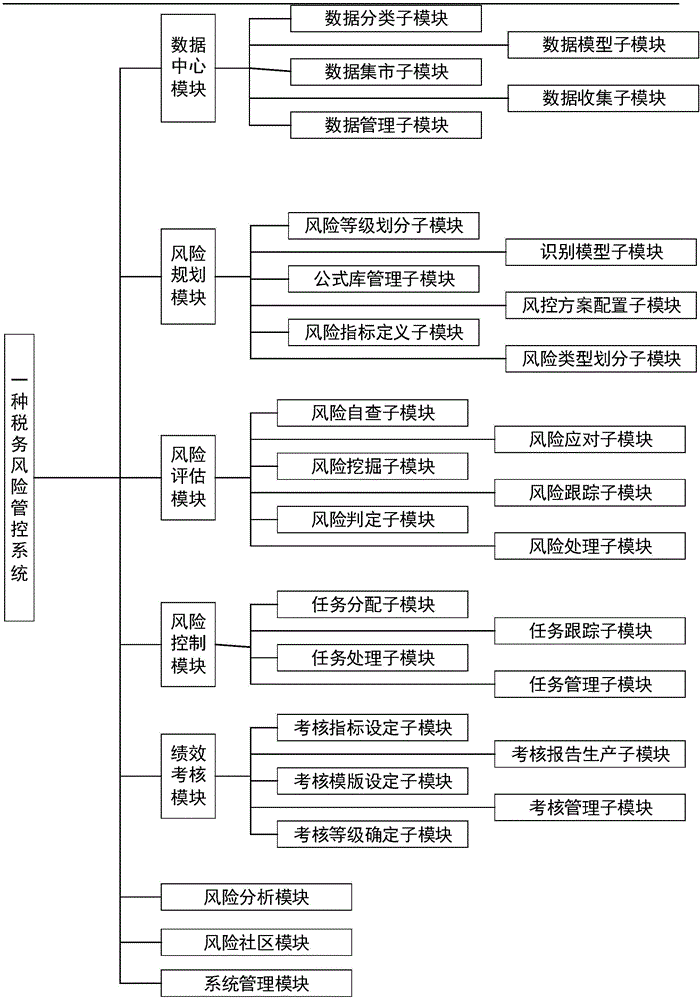

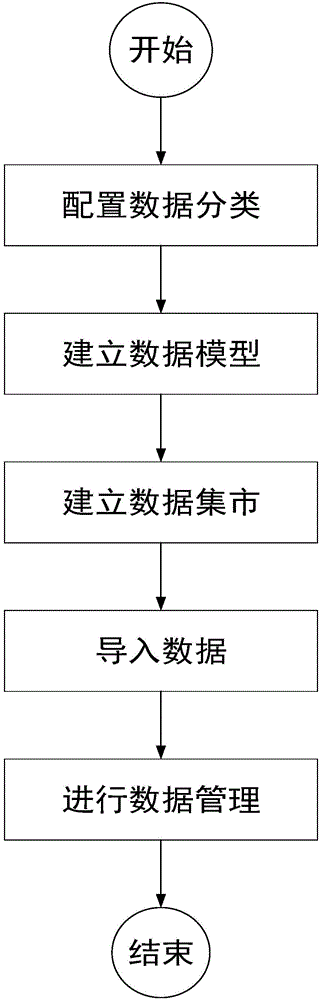

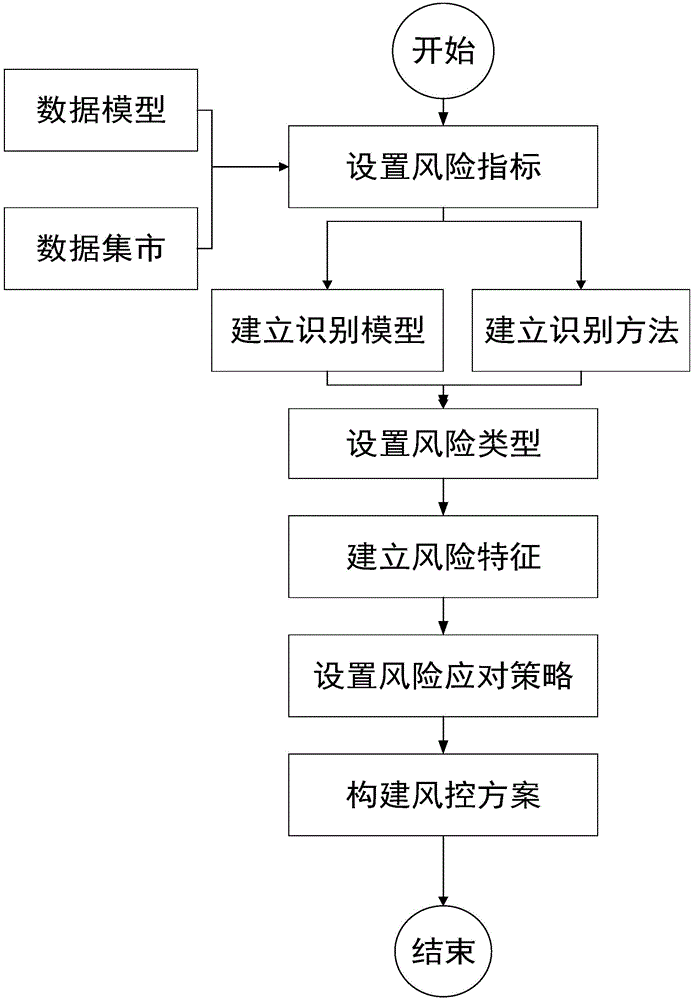

Tax risk management and control system

The invention provides a tax risk management and control system which comprises a data center module, a risk planning module, a risk assessment module, a risk control module, a performance assessment module and a risk analysis module. The data center module is used for defining, modeling and leading in data related to taxes to provide data supports for the tax risk management and control system. The risk planning module is used for establishing a tax risk identification criterion and a tax risk responding strategy. The risk assessment module is used for carrying out quantitative assessments on tax risk doubtful points and providing corresponding responding processing schemes. The risk control module is used for carrying out task distributing, tracking and managing on the responding processing schemes provided through the risk assessment module. The performance assessment module is used for setting assessment items according to complete conditions of tasks tracked, managed and distributed in the risk control module to form an assessment template, and managing an assessment result to form an assessment report. The risk analysis module is used for managing and analyzing various tax risks according to the assessment result of the performance assessment module.

Owner:GUANGZHOU CHENPENG INFORMATION TECH CO LTD

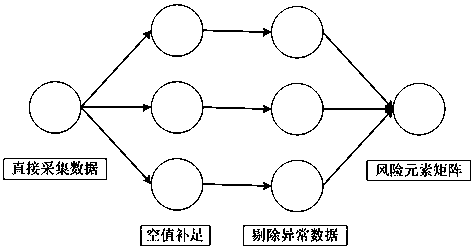

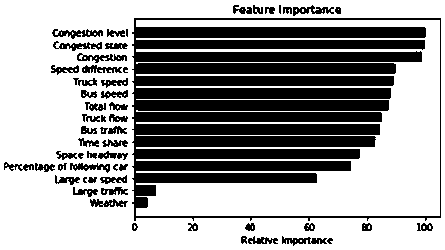

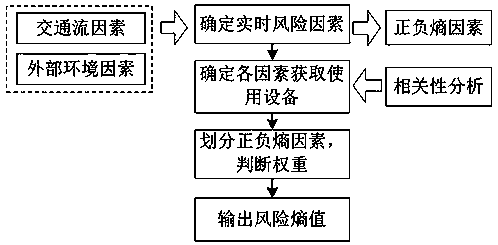

Highway real-time operation risk calculation method

The invention relates to a highway real-time operation risk calculation method. According to the highway real-time operation risk calculation method, a multi-factor-integrated entropy model is adoptedto analyze and calculate the real-time operation of the traffic flow and environment of highways. In accordance with the entropy model, collected data are pre-processed on the basis of real-time traffic flow data and real-time environmental change data acquisition; and on the basis of the real-time operation conditions of the highways, correlation analysis, a random forest model, normalization processing, and the like are adopted with traffic flow risk factors and external environmental factors integrated so as to establish a risk entropy model that can analyze the real-time operation conditions of the highways. With the highway real-time operation risk calculation method of the invention adopted, risk identification, evaluation and analysis can be performed on the real-time operation risks of the highways; reference can be provided for the real-time risk management of the highways; and administration staff can conduct risk disposal and prevention so as to avoid or reduce economic andproperty losses caused by high-risk situations.

Owner:CCCC FIRST HIGHWAY CONSULTANTS

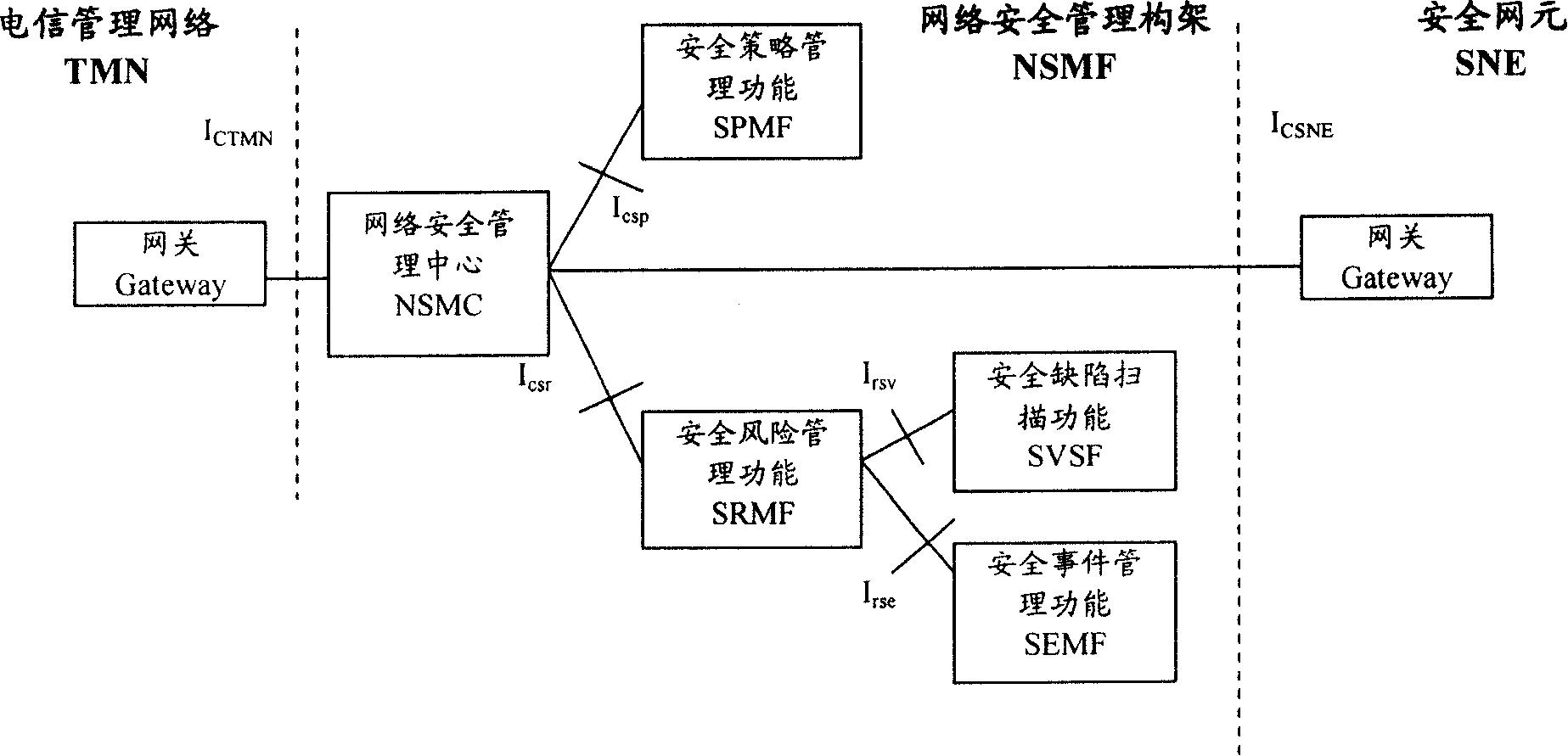

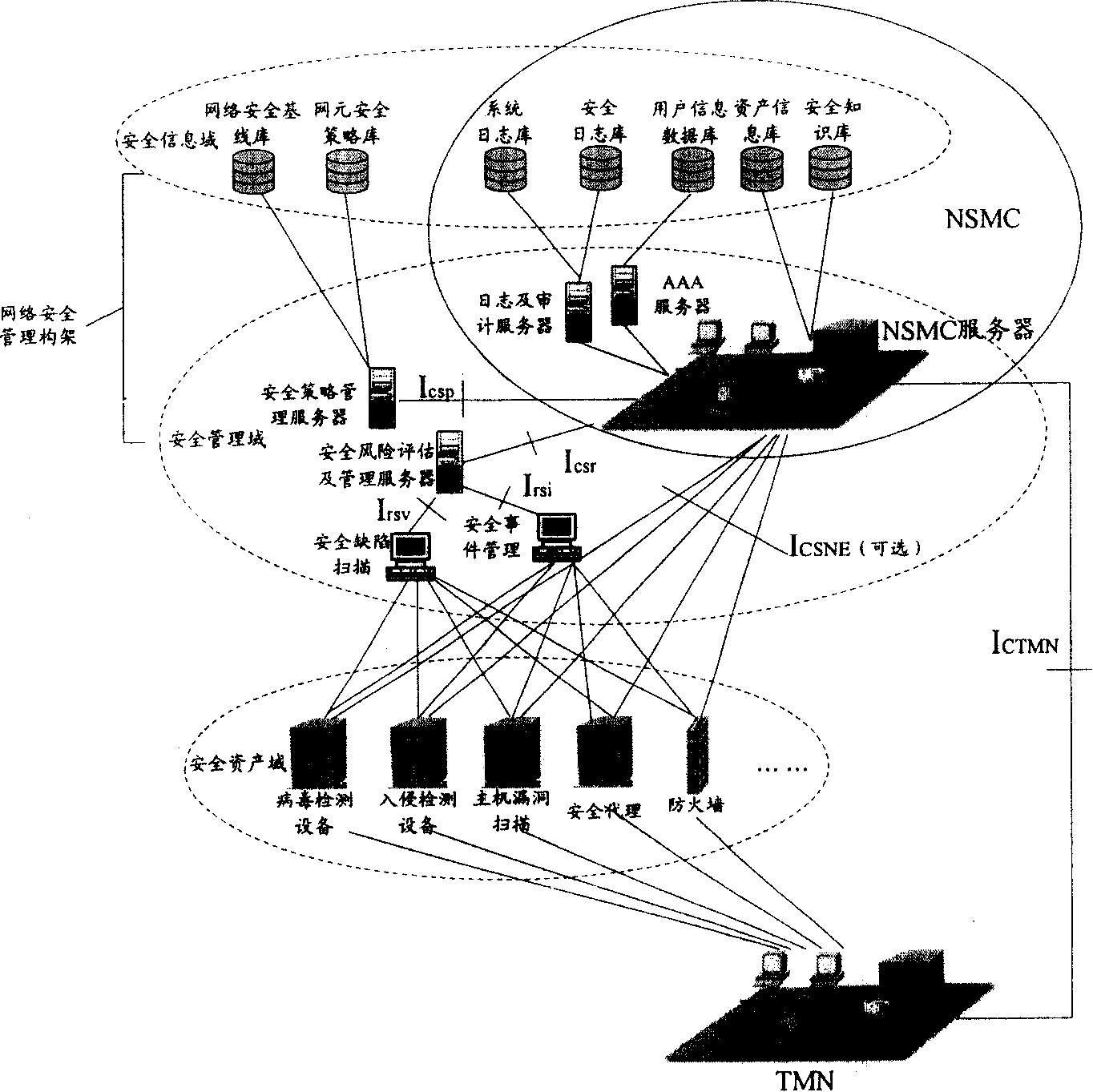

Network safety control construction

InactiveCN101174973ASecurity Management DynamicsData switching networksIT risk managementSafety control

The invention discloses a network safety management frame, which includes a network safety management center and a safety risk management system. The network safety management center controls the network safety management frame in a centralized way, analyzes the safety risk reports from the safety risk management system and finishes the safety configuration of network elements. The safety risk management system collects safe event information and safe defect information and analyzes to obtain the safety risk reports. The invention can provide a network information safe management method which centers on the safety risk management.

Owner:HUAWEI TECH CO LTD

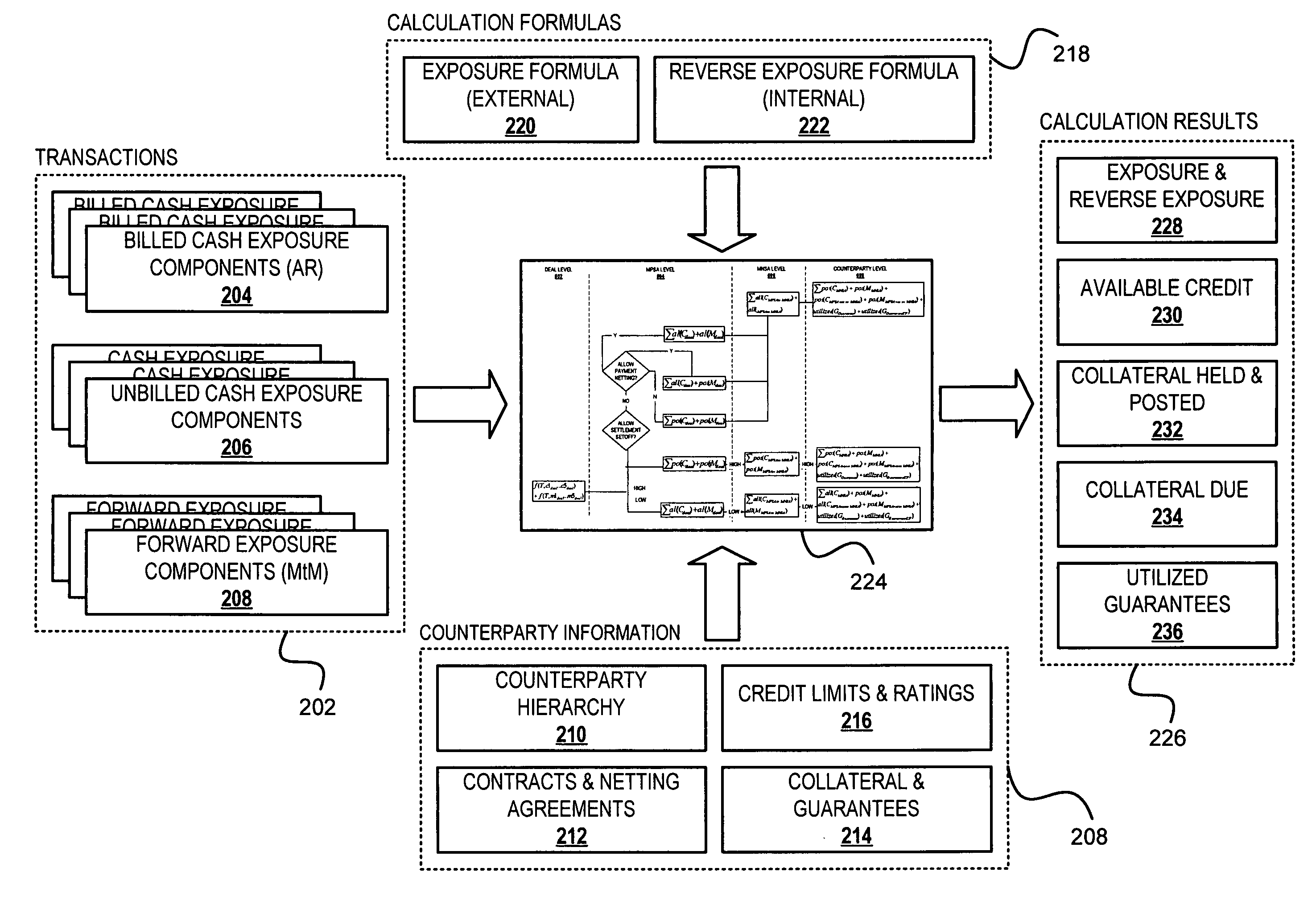

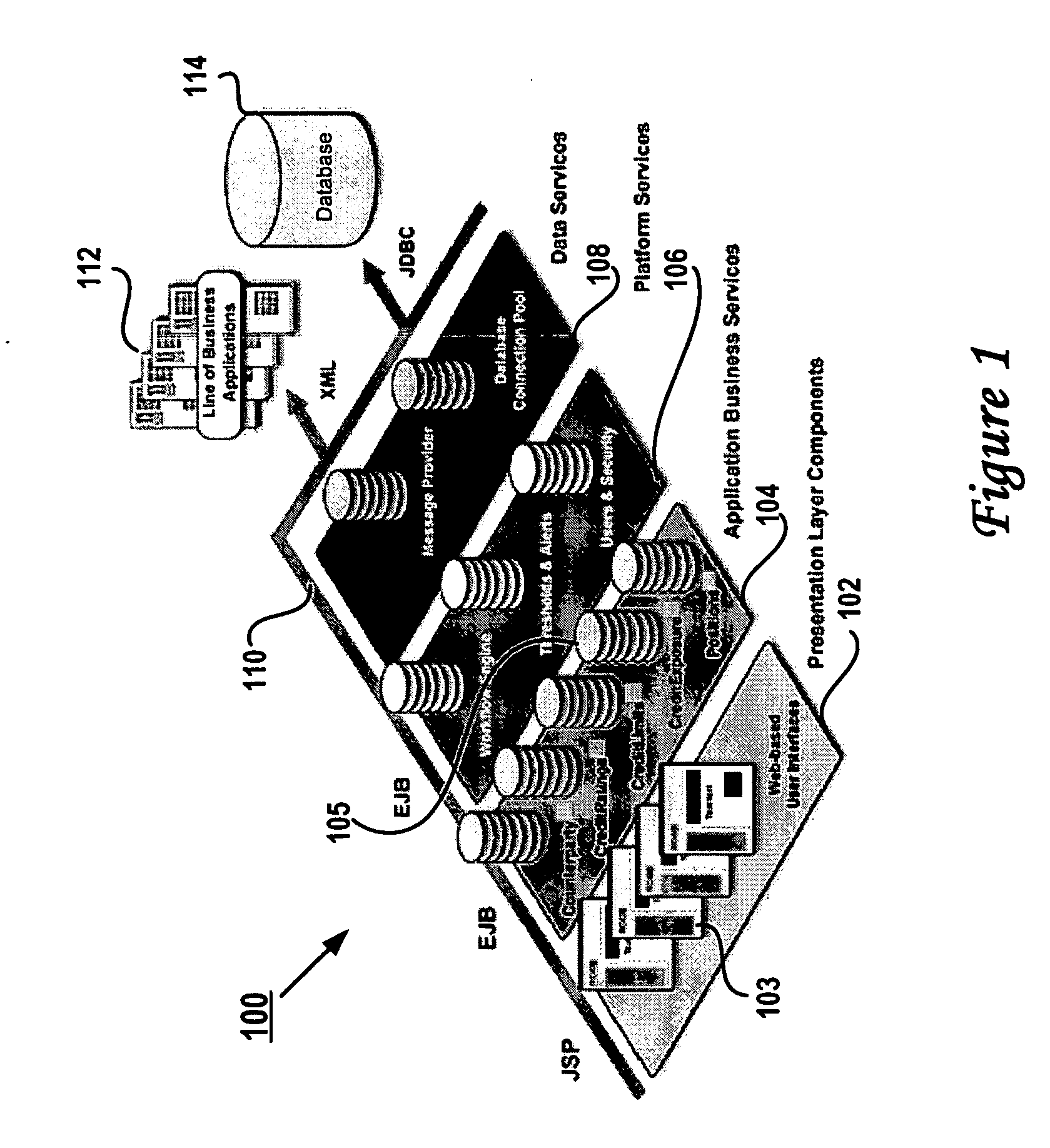

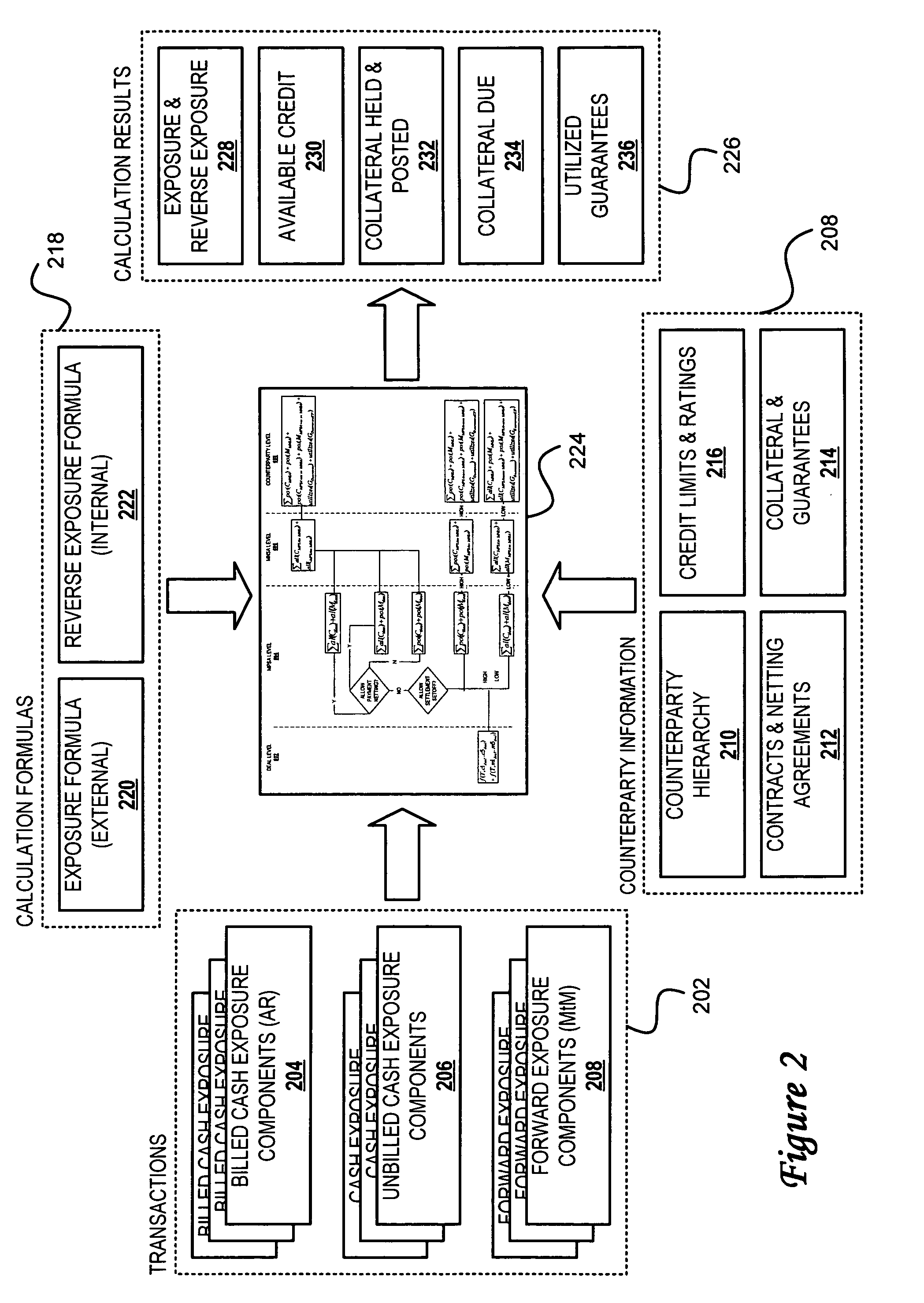

Method, system and program for credit risk management utilizing credit exposure

Software aggregates and integrates credit exposure data across accounting, trading and operational systems within an energy trading organization. A comprehensive model of exposure to all counterparties, across all of their divisions and subsidiaries, is then assembled, enabling the creation of a hierarchical view of each counterparty that models its real-world parent-child relationships, and taking into account netting, setoff, and margin requirements, collateral requirements and contract terms, internal and external views of exposure and liquidity, and risk concentrations based on both system and user-defined risk categories. After aggregating the exposure information, credit, transactions, risk and other properties are determined at any level in the hierarchy and then the system presents a comprehensive, detailed, real-time, enterprise-wide view of current exposure, collateral requirements and outlays for both a company and its counterparties. Walkforward views of potential credit exposure taking into account current and future prices and volumes are also provided.

Owner:ROME CORP

Real-time credit risk management system

InactiveUS20180253657A1Reduce dimensionalityRemove noiseFinanceEnsemble learningIT risk managementStatistical learning

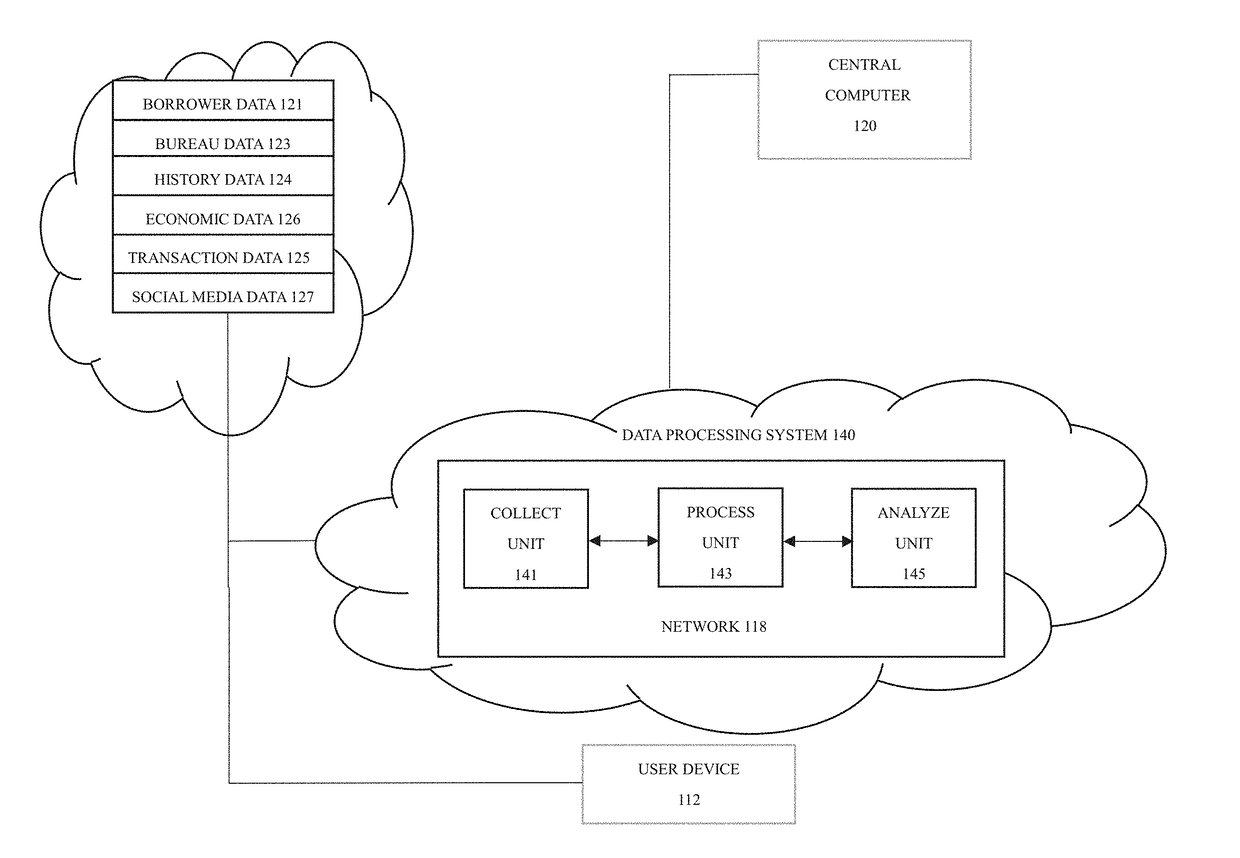

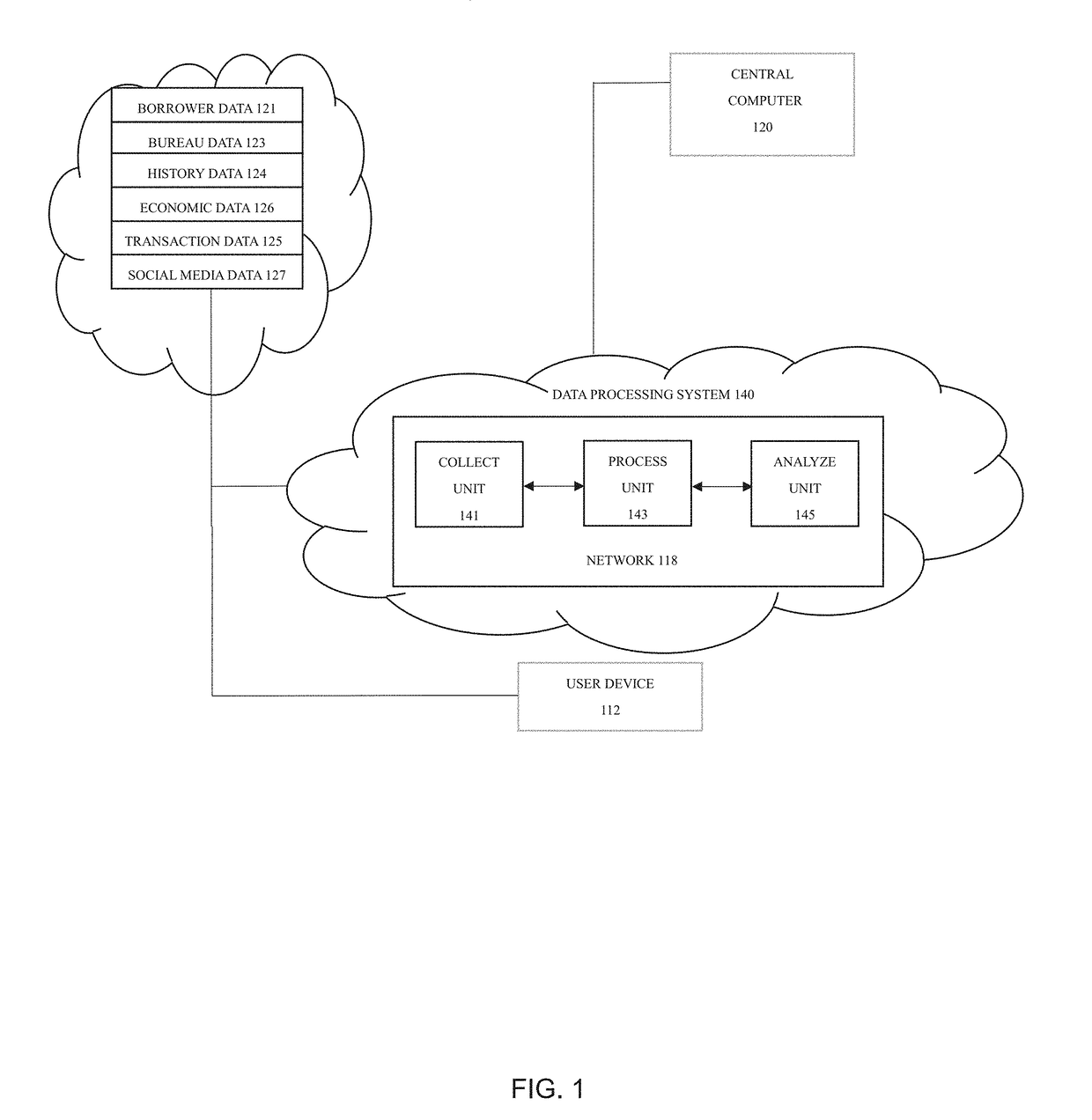

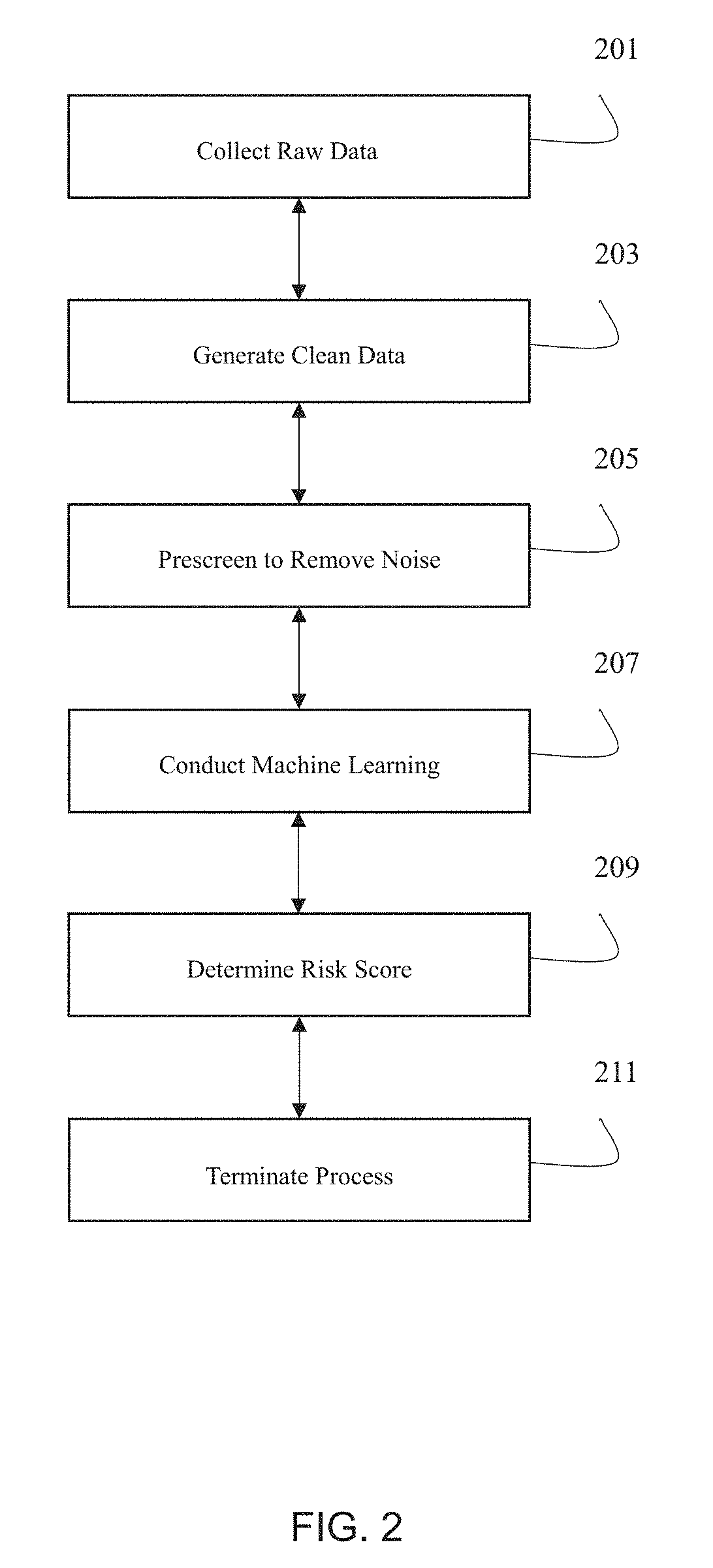

The present invention generally relates to a system and method for incorporating computational infrastructure within a statistical learning framework for real-time risk assessment and decision making.

Owner:ZHAO LIANG +1

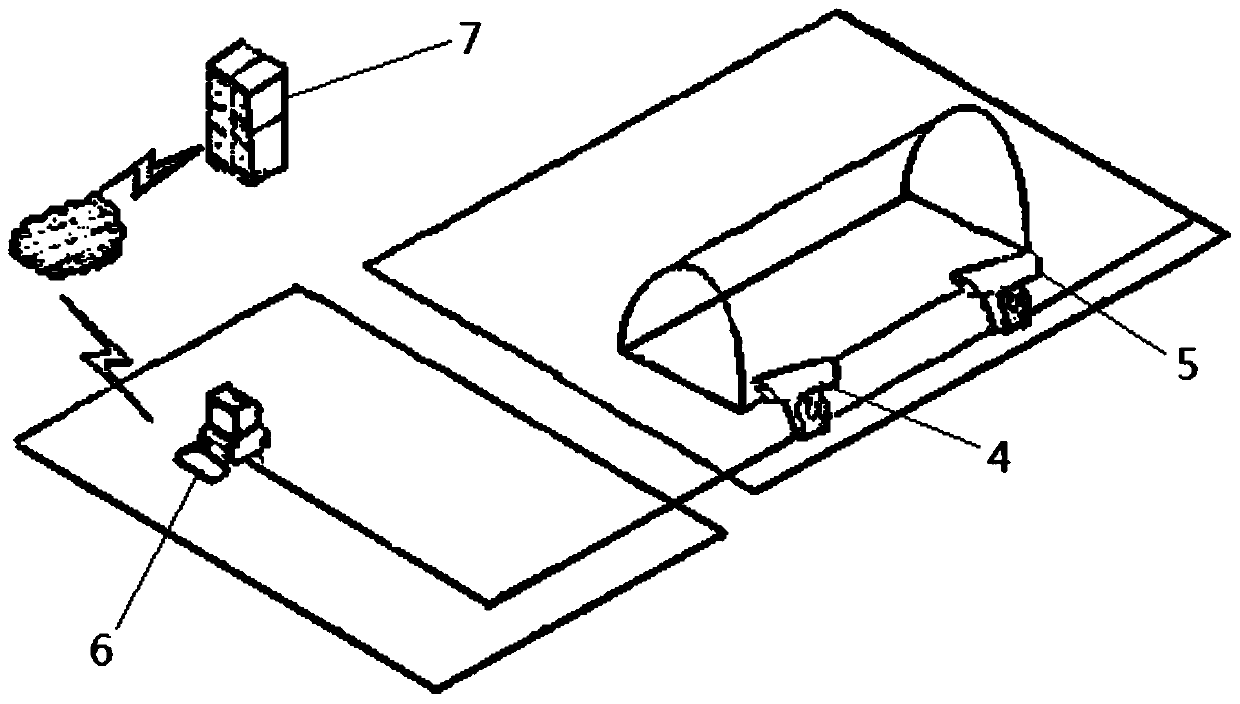

Risk management and control system for tunnel construction based on space and time parameters

ActiveCN110411370AConstruction safetyGuarantee smooth constructionUsing optical means3D modellingInformatizationIT risk management

The invention relates to a risk management and control system for tunnel construction based on space and time parameters. The system at least comprises a plurality of ground three-dimensional laser scanning devices and a plurality of data processing modules, wherein the first data processing module is configured to determine a space correlation function between every two continuous tunnel sectionsurfaces in three-dimensional coordinates, and based on the space correlation functions, an imported BIM three-dimensional informatization simulation model is instructed for being corrected, so that aBIM three-dimensional informatization measurement model with a dynamic update of a to-be-constructed tunnel is obtained; the second data processing module is configured to analyze detection values ofdifferent tunnel section surfaces in the space correlation functions and determine a time-varying space correlation function of each tunnel section surface, a time-varying trend of each tunnel section surface is indicated based on the corresponding time-varying space correlation function, surface varying values obtained through calculation are judged according to a preset varying threshold, and automatic early warning is conducted for the tunnel sections with the surface varying values exceeding the preset varying threshold.

Owner:北京住总集团有限责任公司

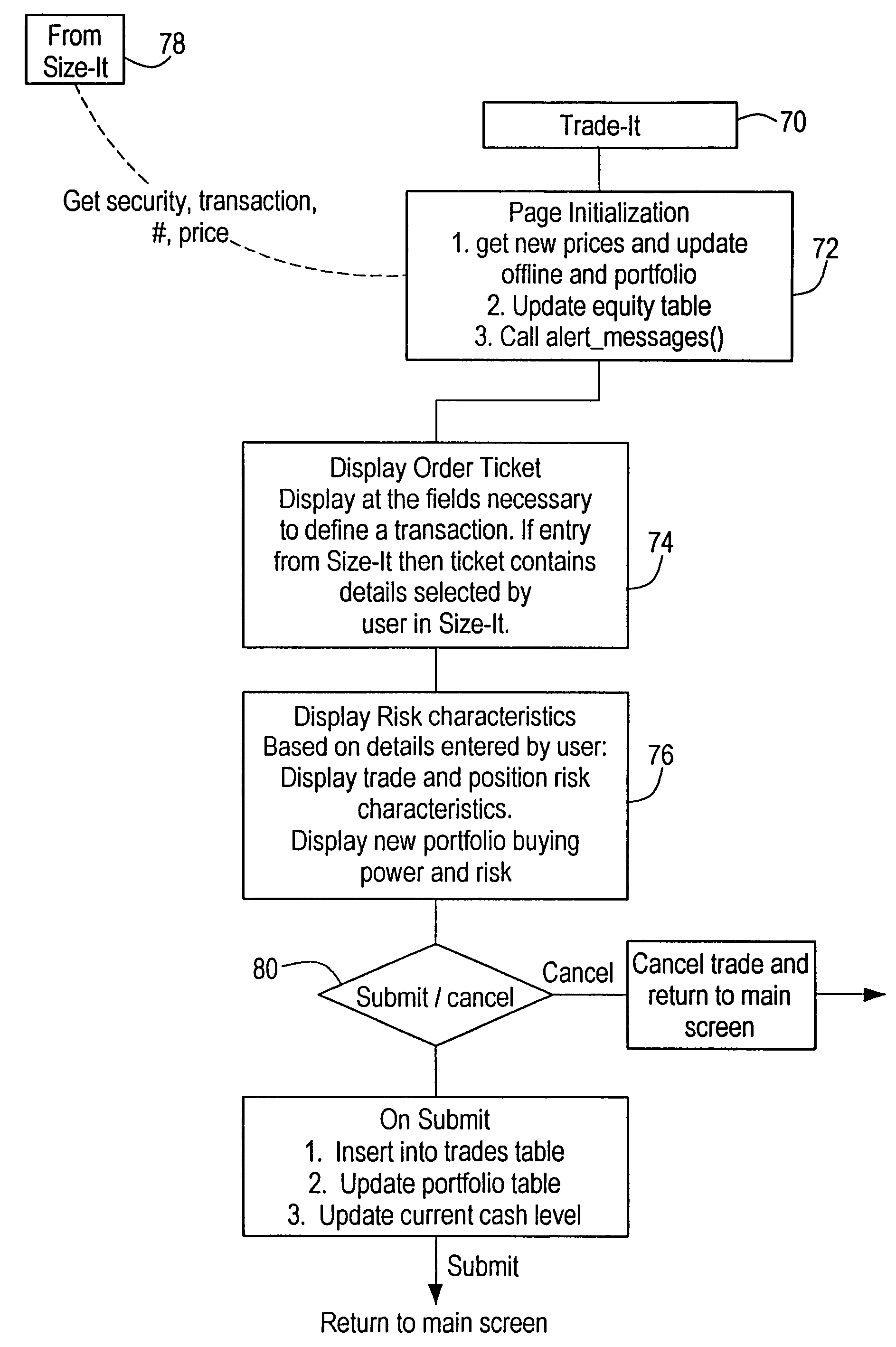

Portfolio accounting and risk management system

A method and system for managing investment portfolio risk on a computer system. A plurality of parameters, including an identifier, a market price, a stop-loss price, a commission, a skid, and a number of shares or contracts all associated with an investment instrument, are stored on a computer-readable medium, along with an equity value associated with a user's portfolio. A point risk value is determined for a potential investment. The point risk value is an intermediate value multiplied by the number of shares or contracts, the intermediate value comprising the market price minus the stop-loss price plus the commission plus the skid (for long transactions). A plurality of risk scenarios are displayed showing proposed numbers of shares or contracts associated with the point risk value for a plurality of selected size risk values. Other risk characteristics may also be determined and displayed.

Owner:BARON TRUST

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com