A risk management system for securities

a risk management and securities technology, applied in the field of securities risk management systems, can solve the problems of no agreed method and cumbersome manoeuvre, and achieve the effect of removing time lag

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

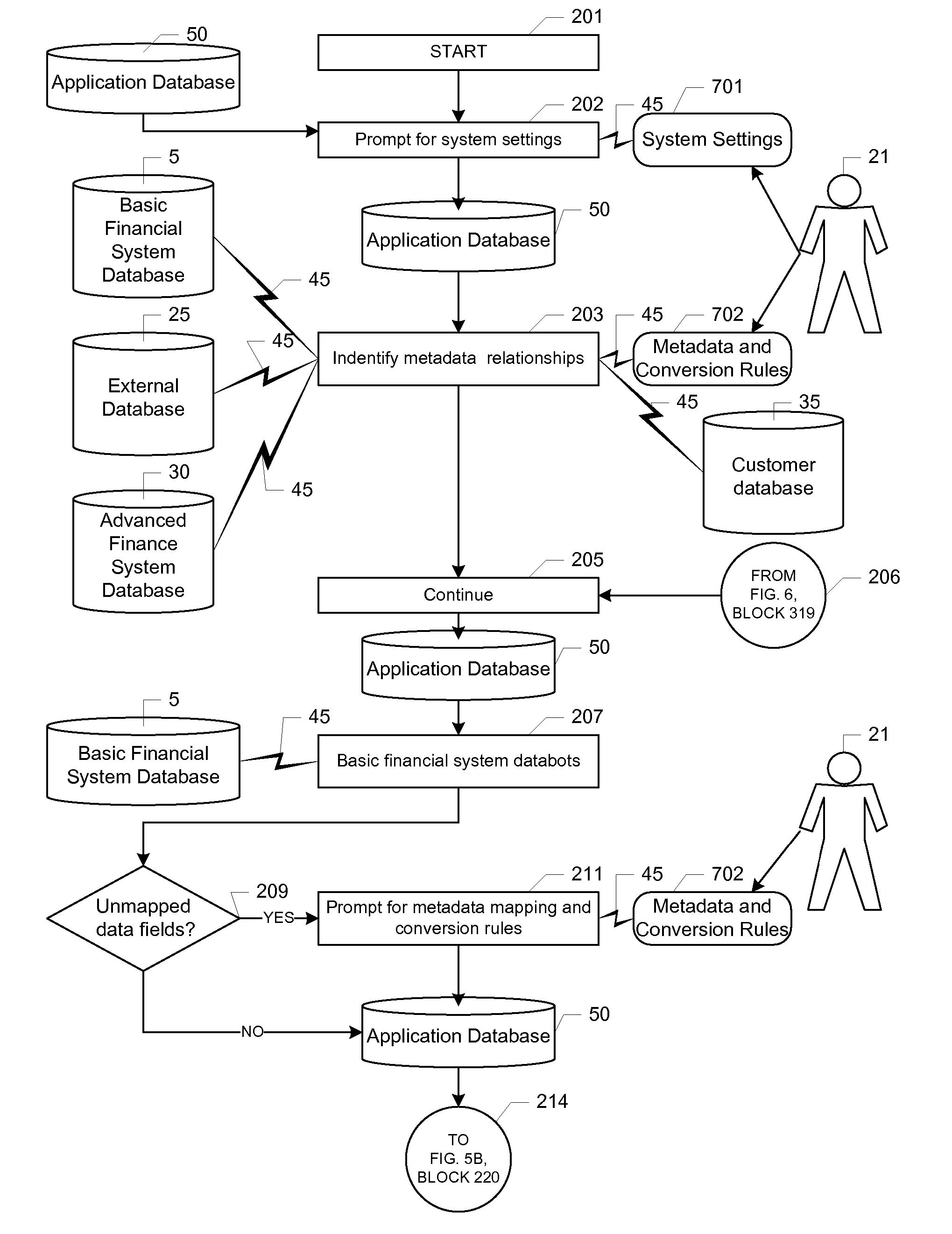

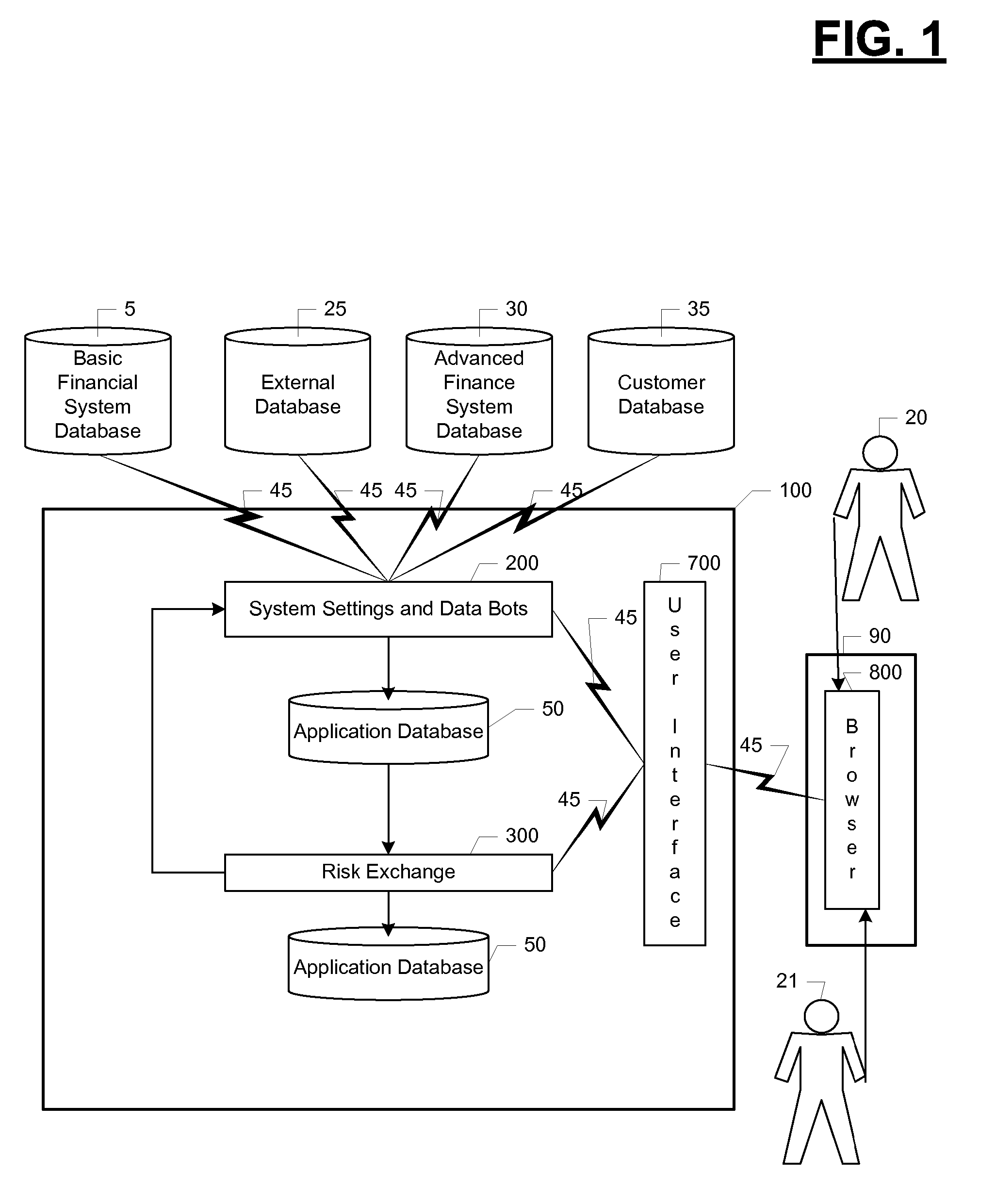

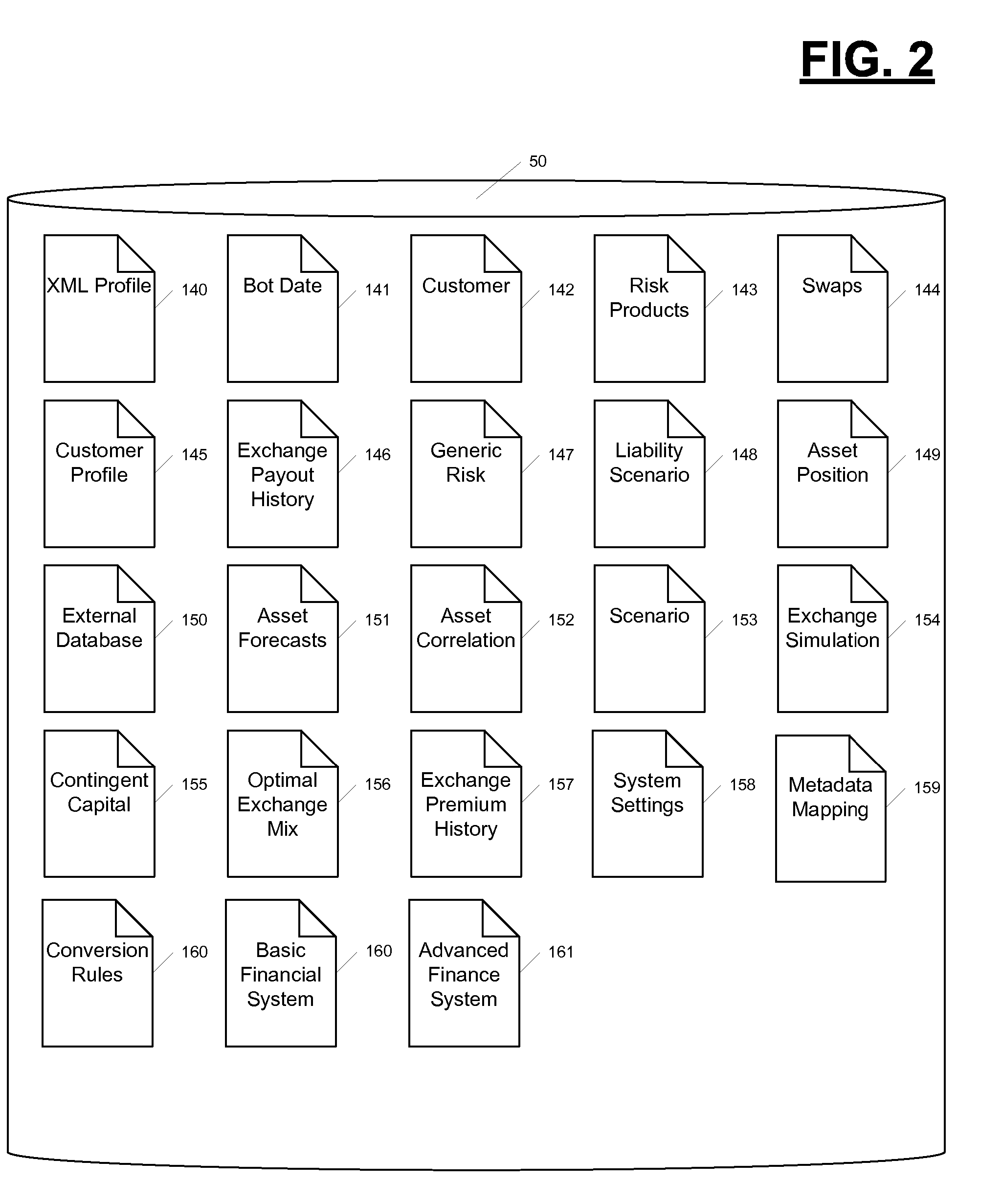

[0020]FIG. 1 provides an overview of the processing completed by the system for the collaborative, on-line development and delivery of customized risk transfer programs. In accordance with the present invention, an automated method of and system (100) for collaborative, on-line development and delivery of customized risk transfer programs is provided. Processing starts in this system (100) with the specification of system settings and the initialization and activation of software data “bots” (200) that extract, aggregate, manipulate and store the internal data, external data and customer data used for completing system processing. The data from external databases is used to analyze generic event risks and prices on investments for the asset classes and contingent liabilities specified by the system operator (21). In one embodiment, a customer financial model is created in order to identify the impact of the different elements of value, external factors and risks on customer financia...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com