Patents

Literature

51 results about "Market activity" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

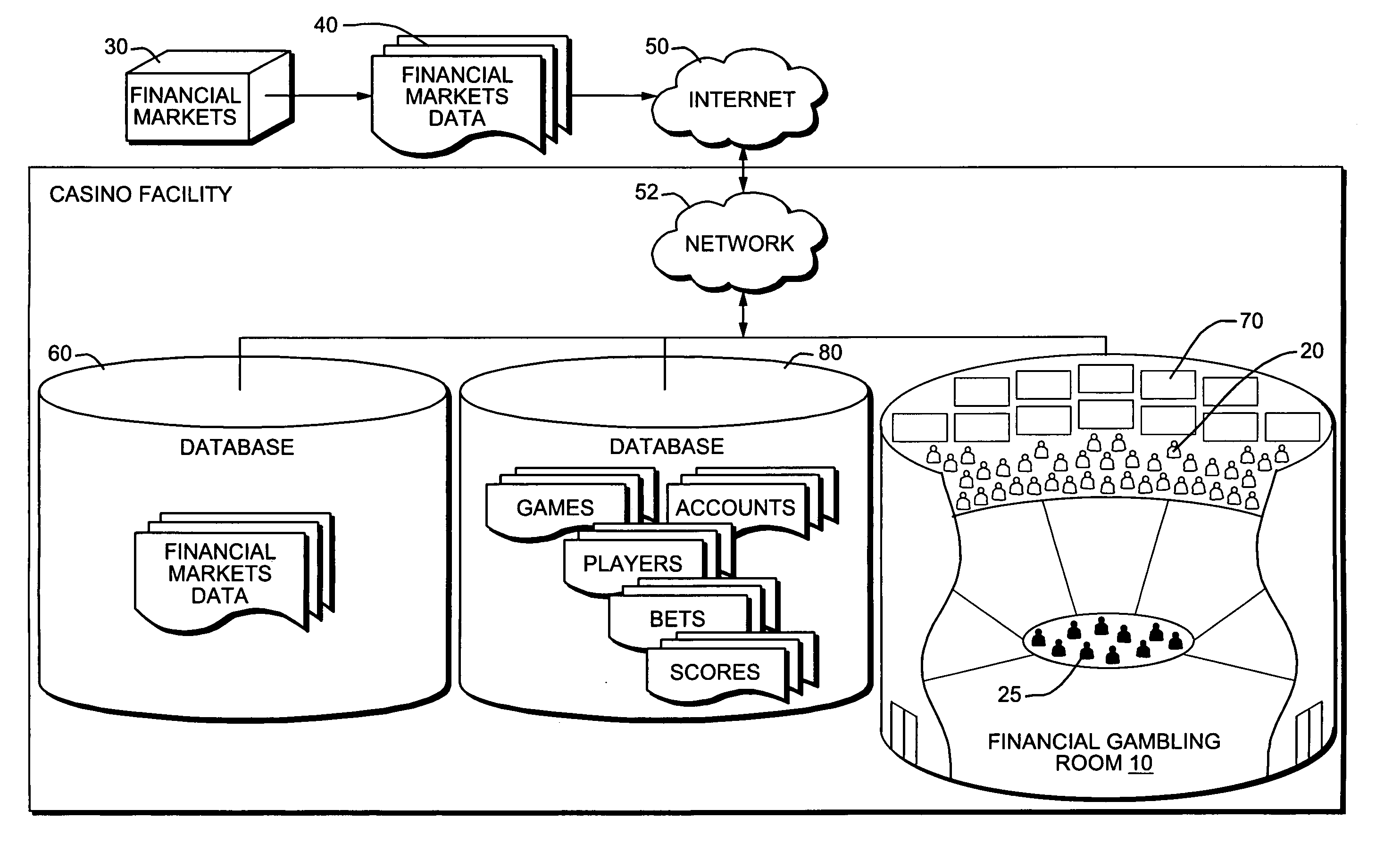

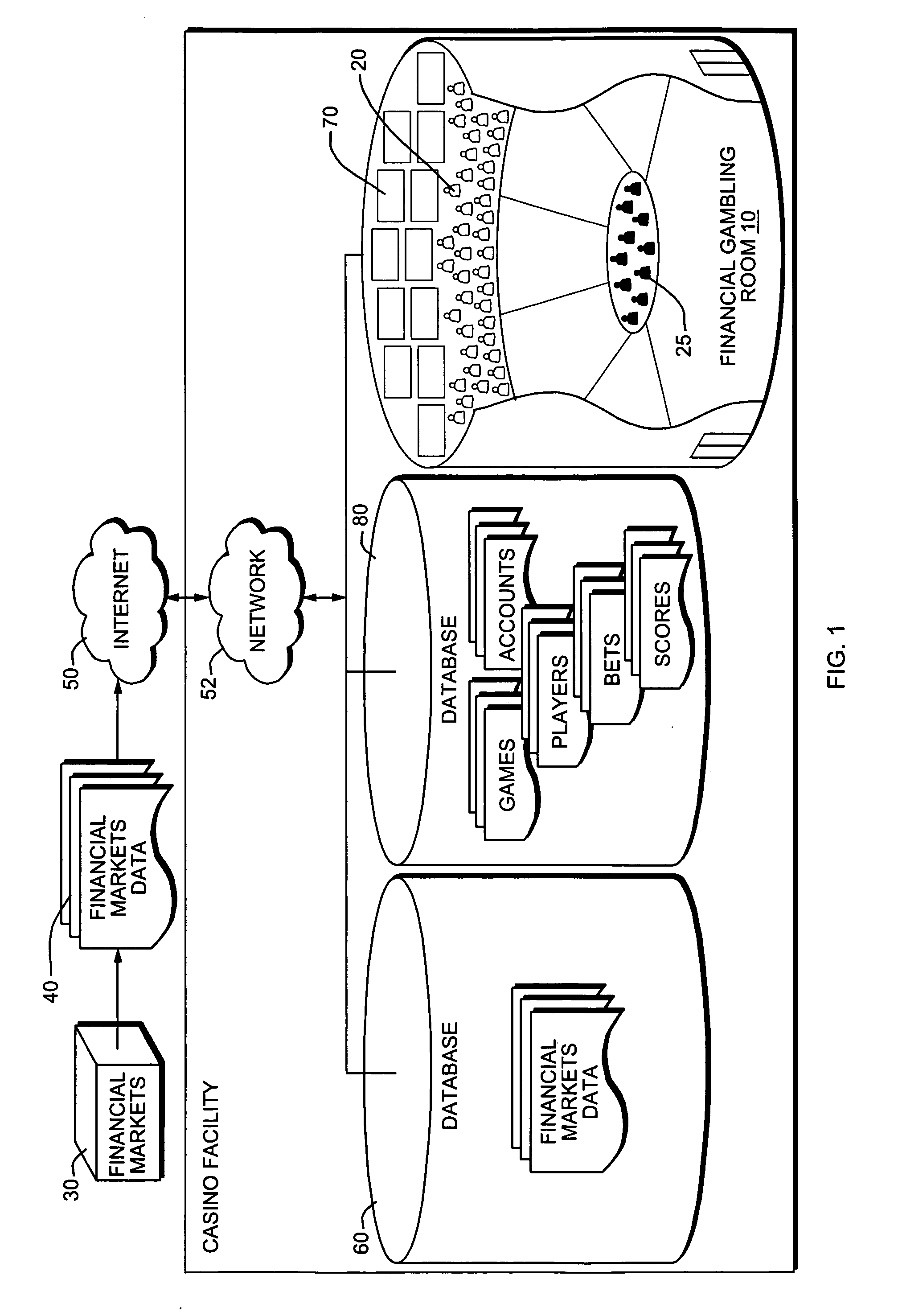

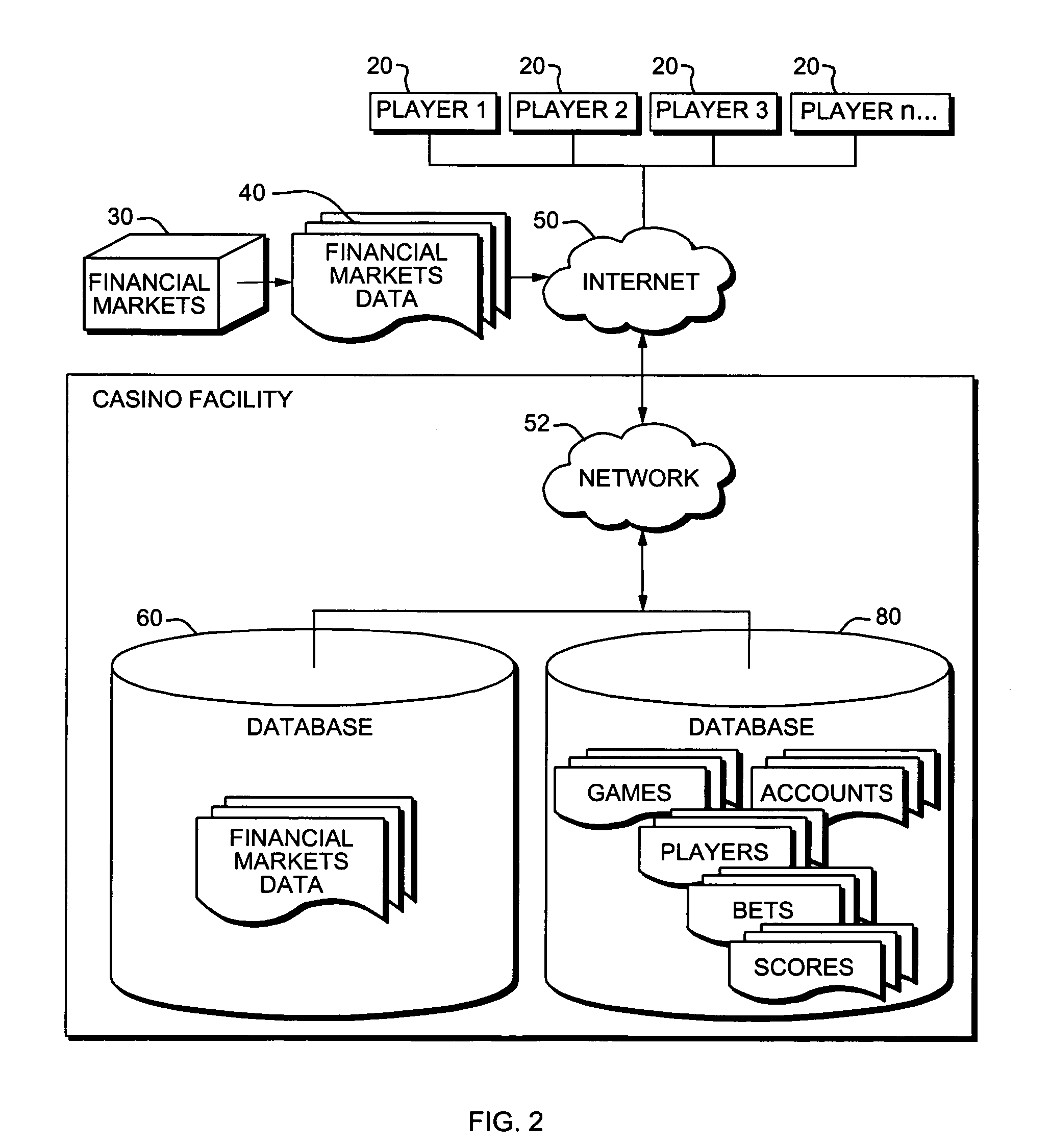

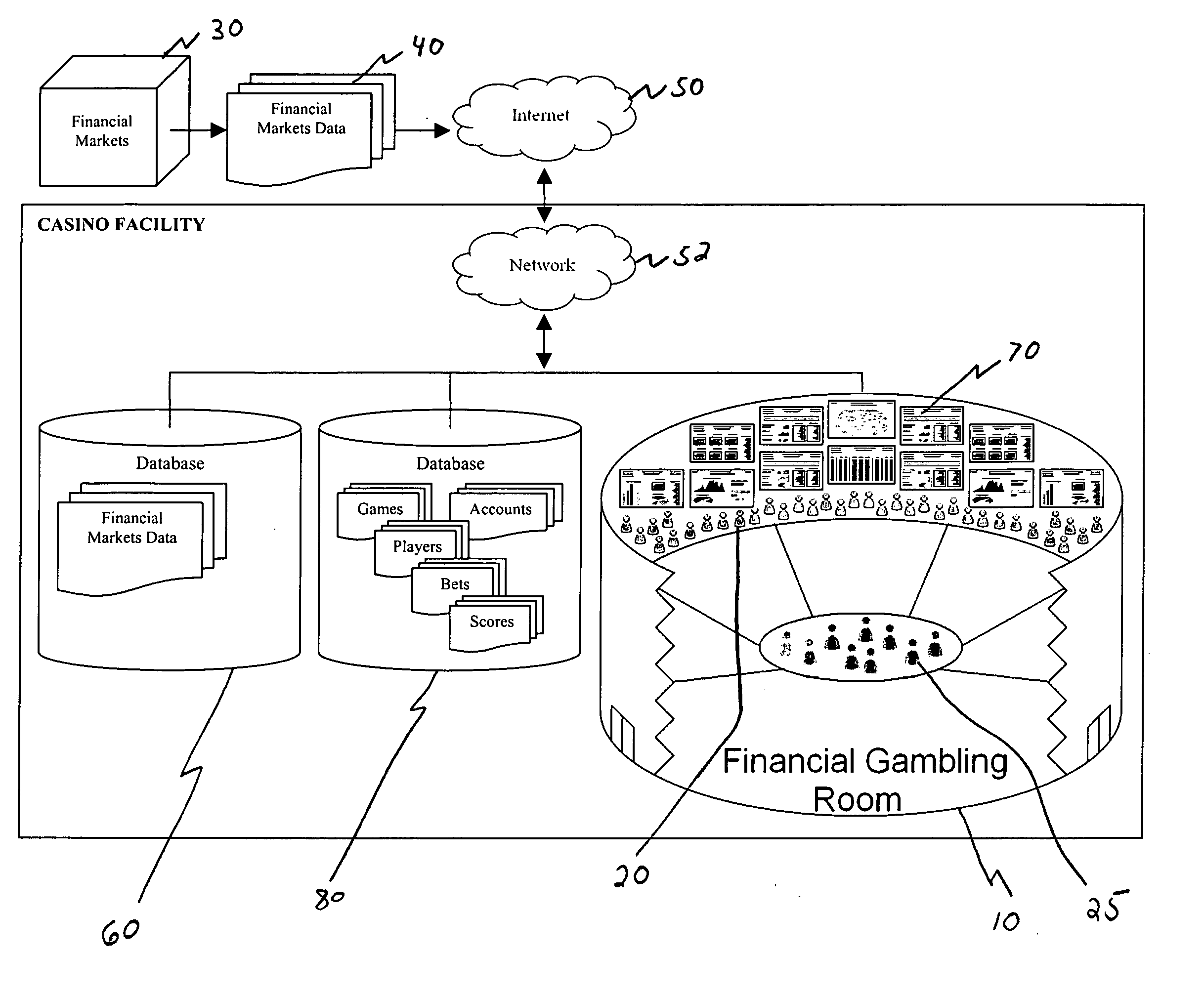

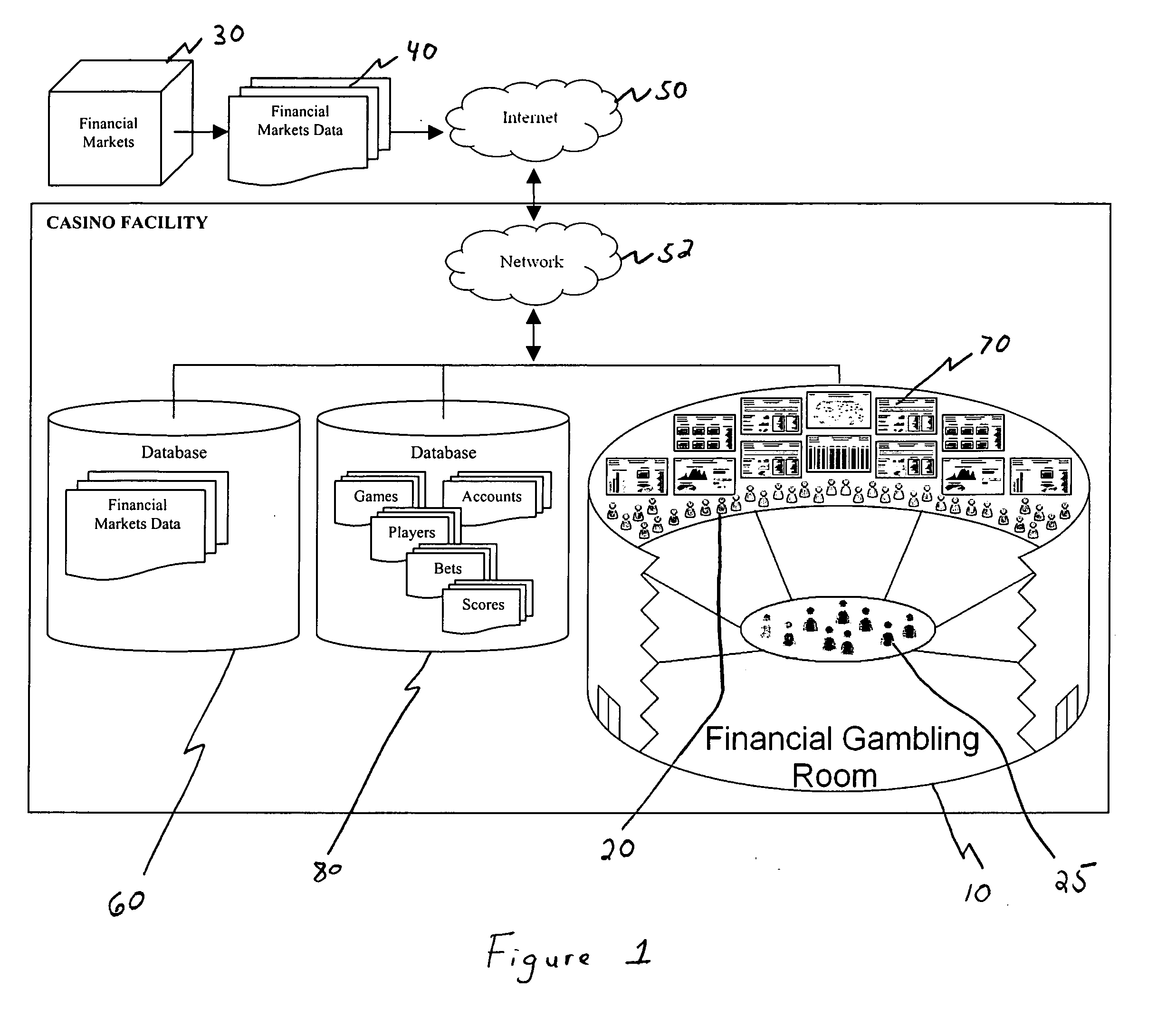

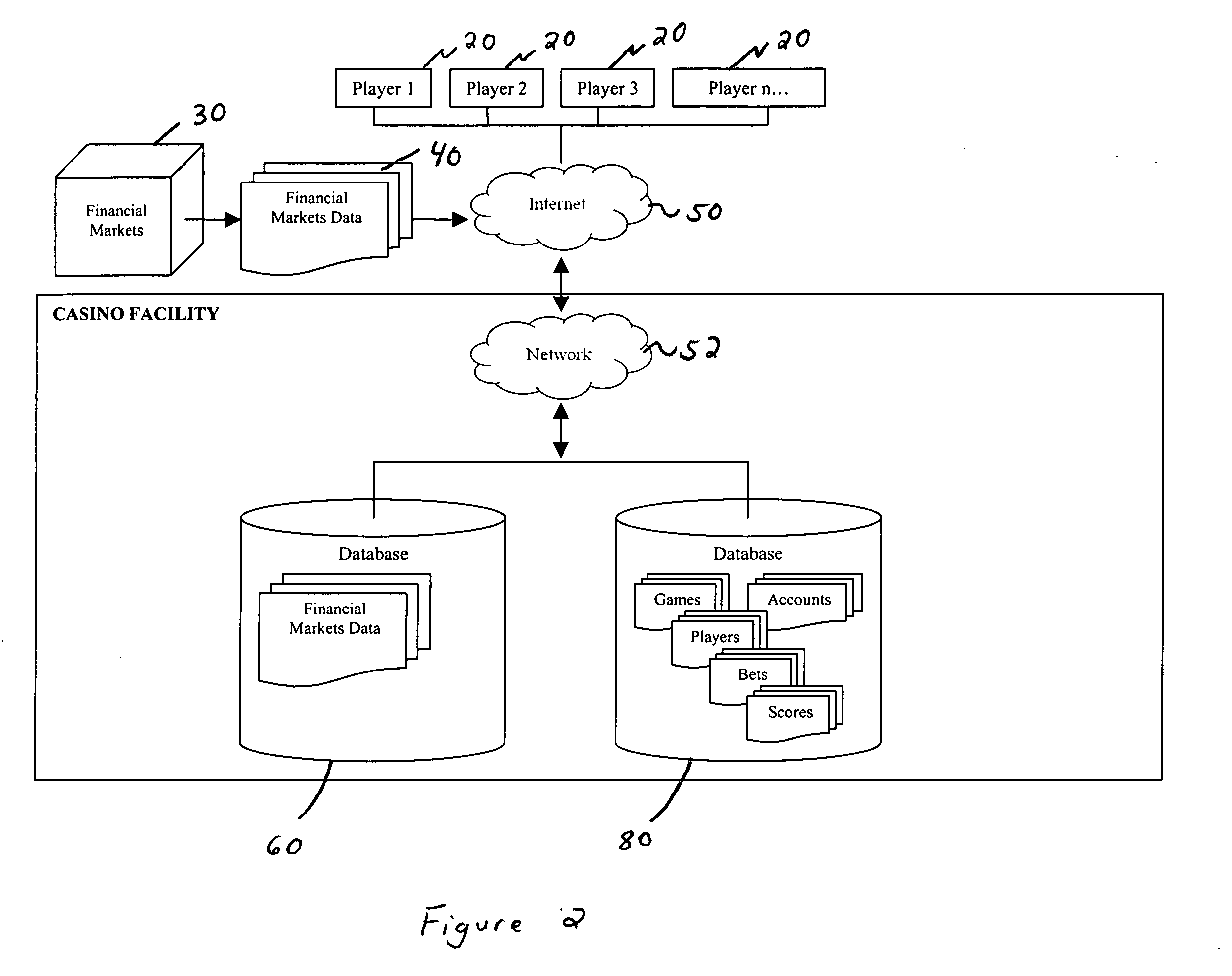

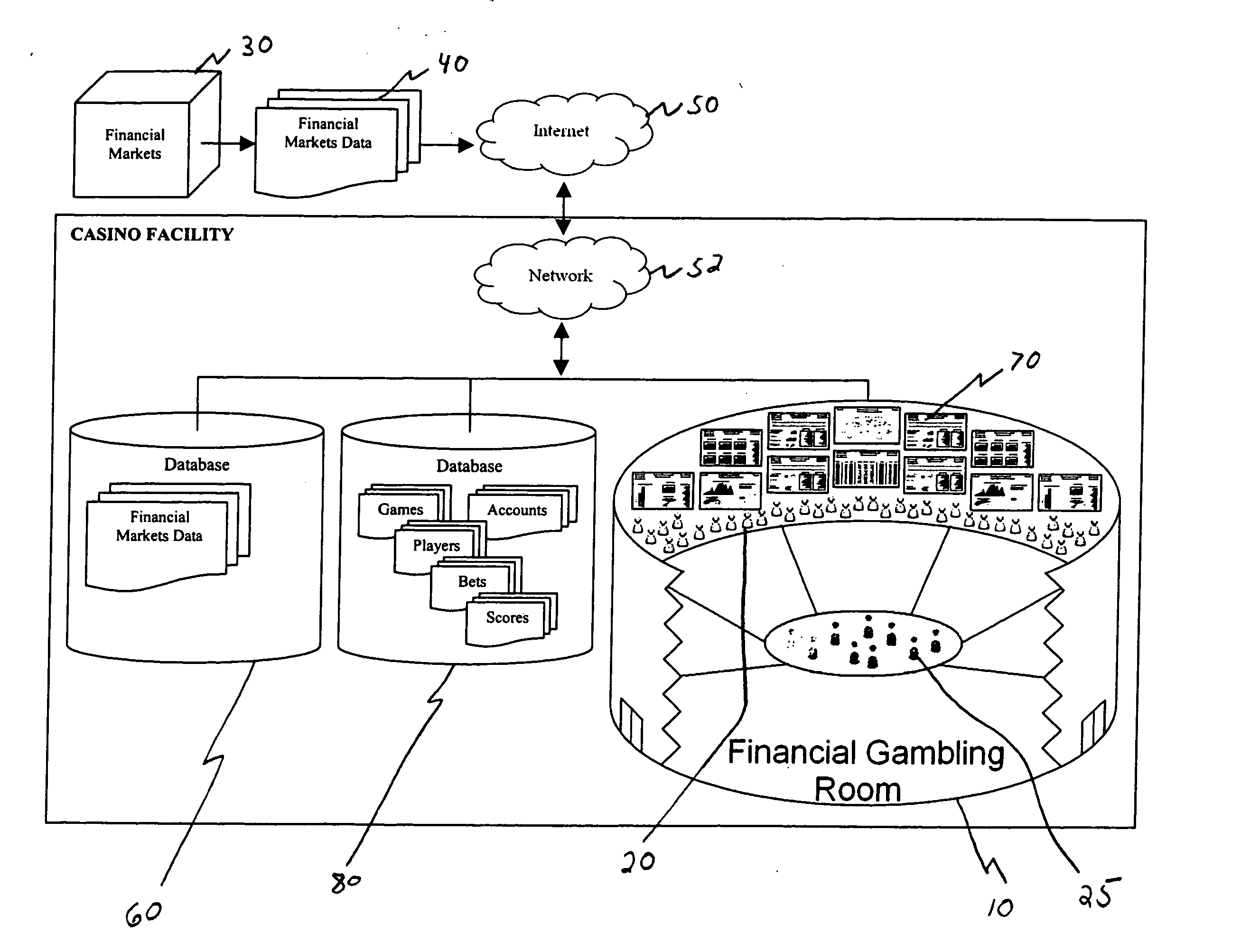

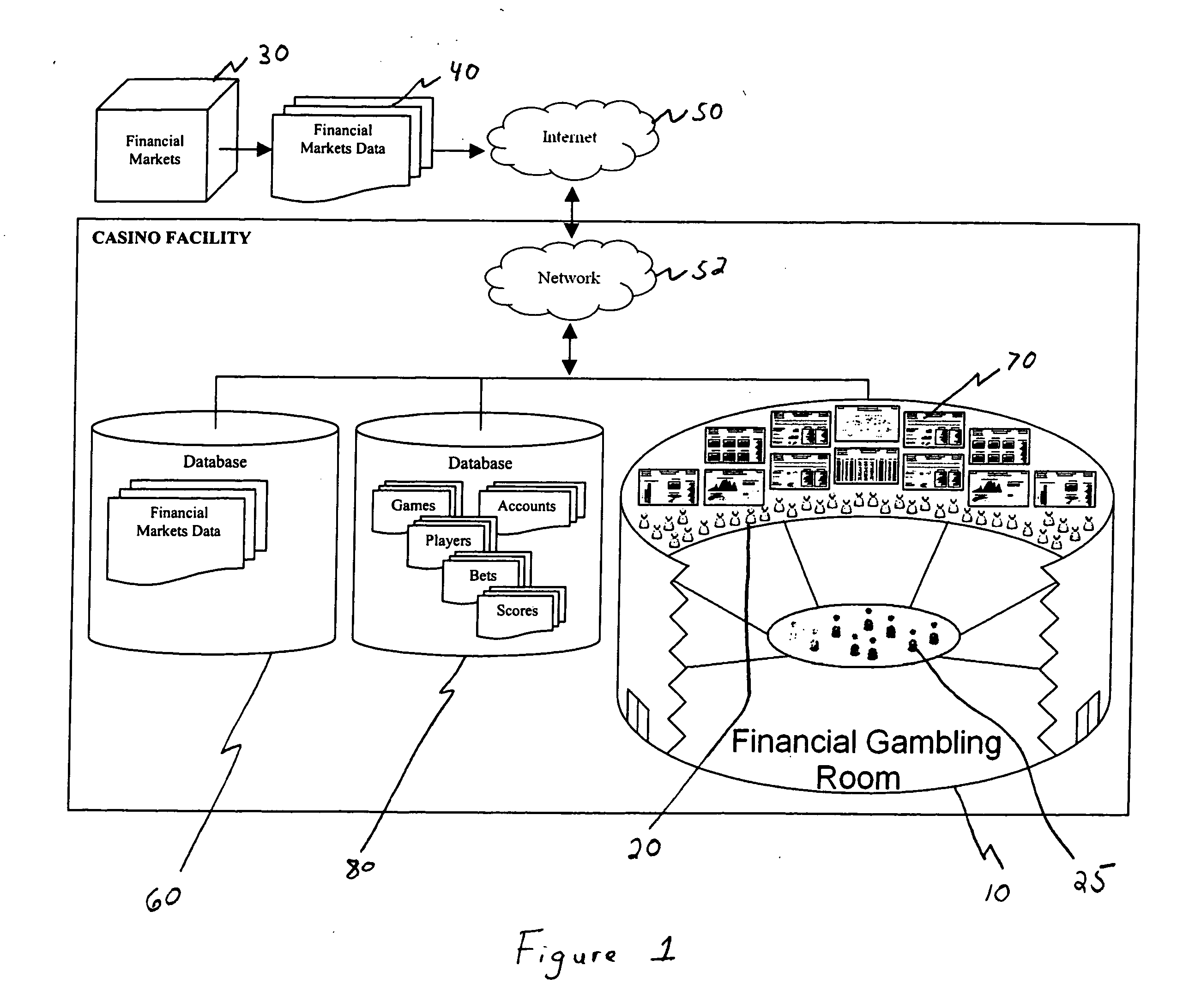

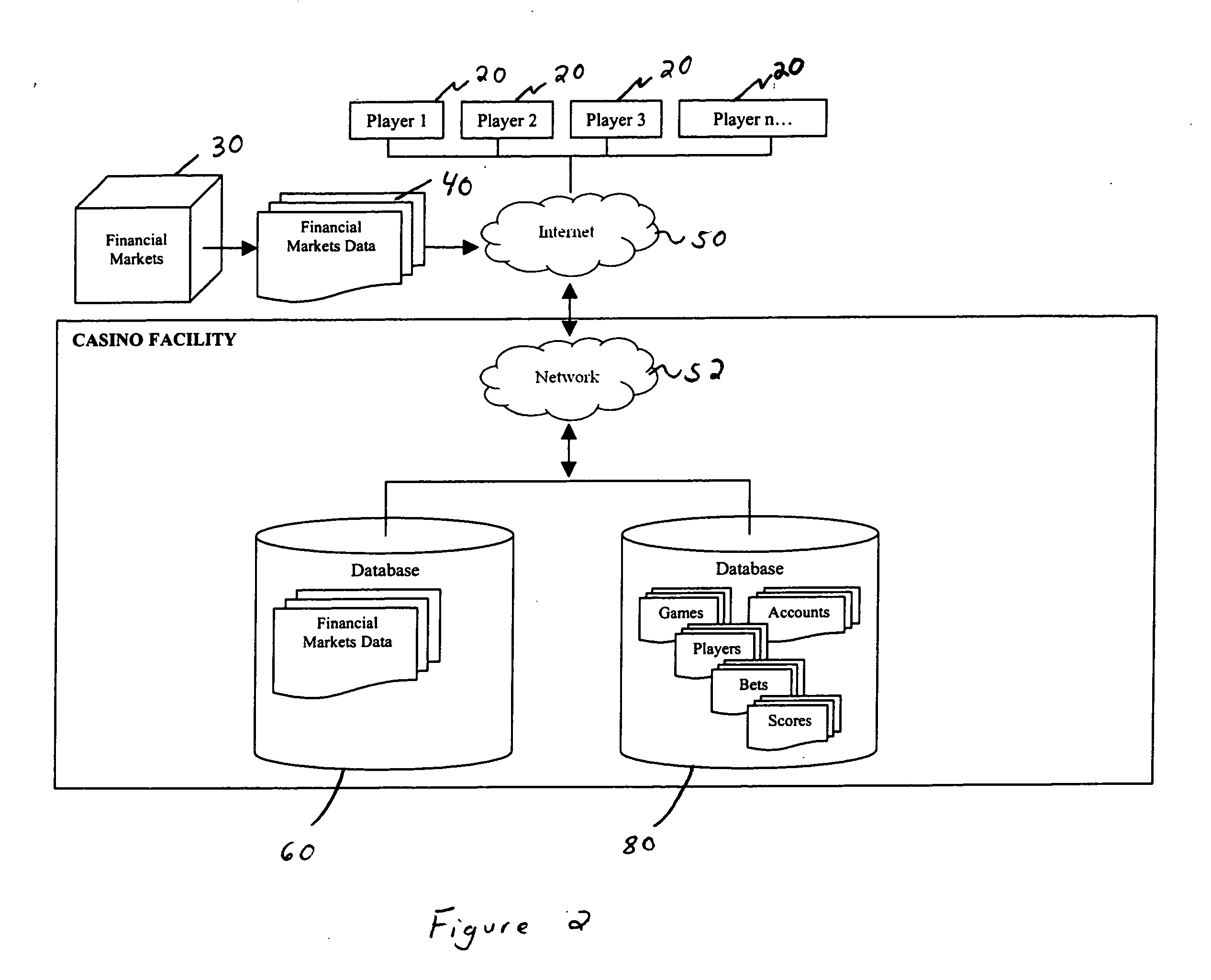

Casino games based on financial market activity

The present invention is directed to a method for conducting a game by a gambling operator or casino in which a plurality of players bet. A set of rules are established for the game, wherein the rules define at least one winner based on at least one financial market data value that fluctuates based on market activity in a financial market that is distinct from the game. Updates to the financial market data value are received electronically from a third-party data source. A forum is electronically coupled to the third-party data source, where the players play the game and bet against a house, in accordance with the established set of rules and the at least one financial market data value. The forum is electronically coupled to one or more third-party market makers who establish odds for the game and provide liquidity for bets of all players. The one or more third-party market makers payout winning bets to one or more winning players based on the established odds, and retain losing bets of one or more losing players.

Owner:DELTA RANGERS

Casino game based on financial market activity

The present invention is directed to a method used by a casino for conducting a casino game in which a plurality of players bet against each other. A set of rules is established for the game. The rules define a winner based on at least one financial market data value that fluctuates based on market activity in a financial market that is distinct from the game. Updates to the financial market data value are electronically received from a third-party data source. A forum that is electronically coupled to the third-party data source is provided where the players play the game against each other in accordance with the established set of rules and the at least one financial market data value. The casino collects a fee for conducting the game.

Owner:DELTA RANGERS

Casino games based on financial market activity

The present invention is directed to a method for conducting a game in which a plurality of players bet. A set of rules is established for the game. The rules define a winner based on at least one financial market data value that fluctuates based on market activity in a financial market that is distinct from the game. Updates to the financial market data value are electronically received from a third-party data source. A forum that is electronically coupled to the third-party data source is provided where the players play the game in accordance with the established set of rules and the at least one financial market data value. A gambling operator or casino collects a fee for conducting the game.

Owner:DELTA RANGERS

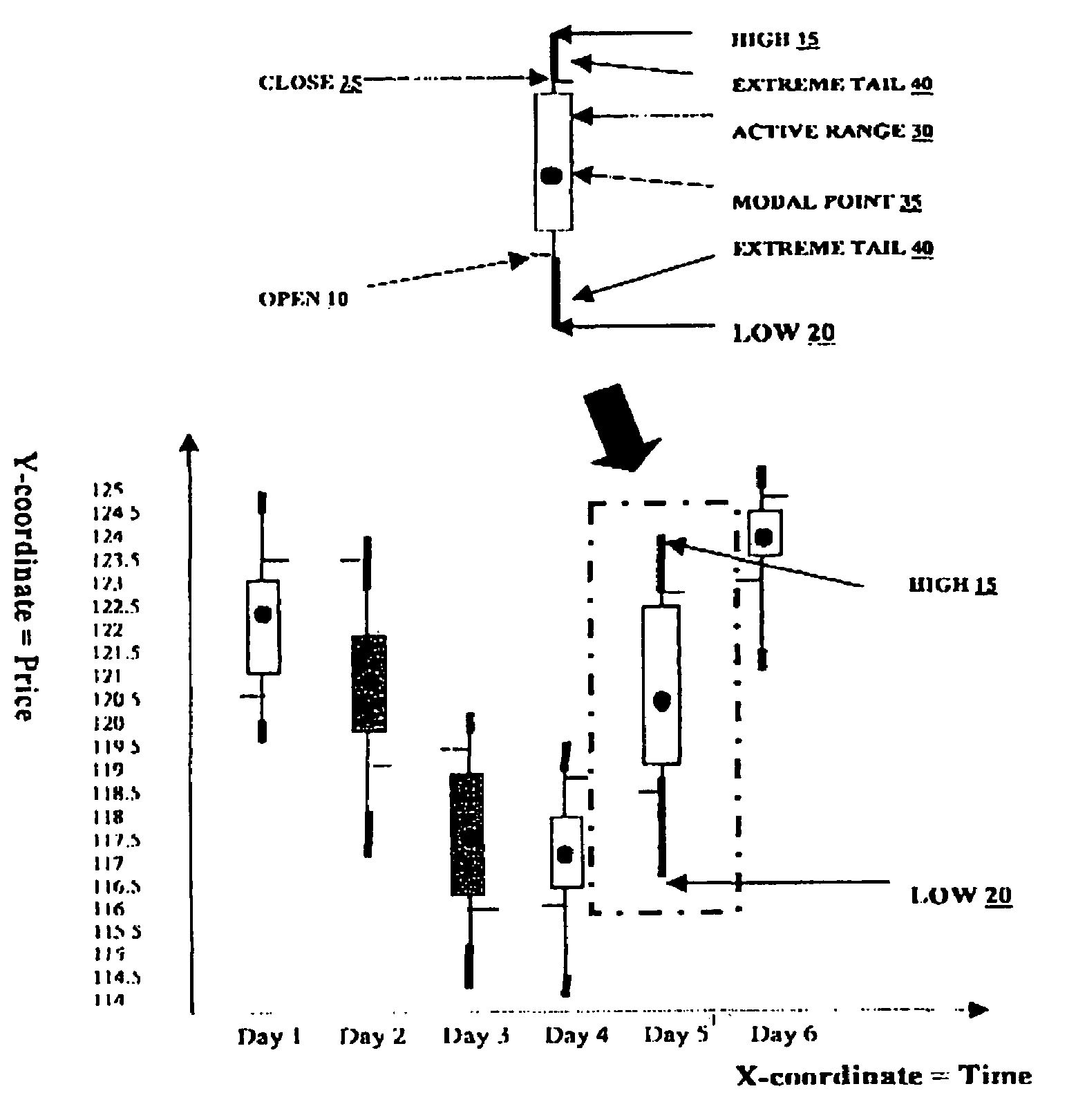

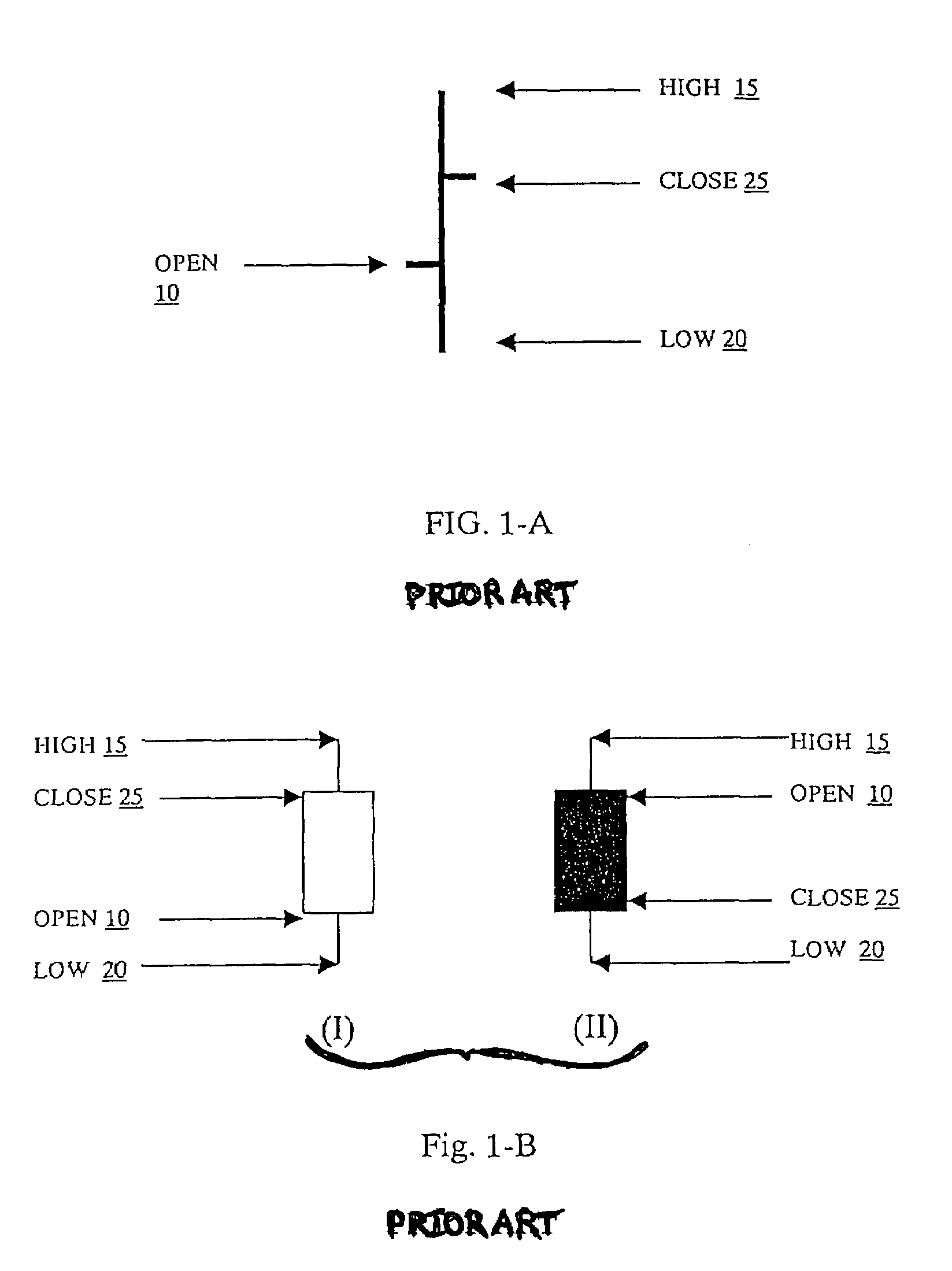

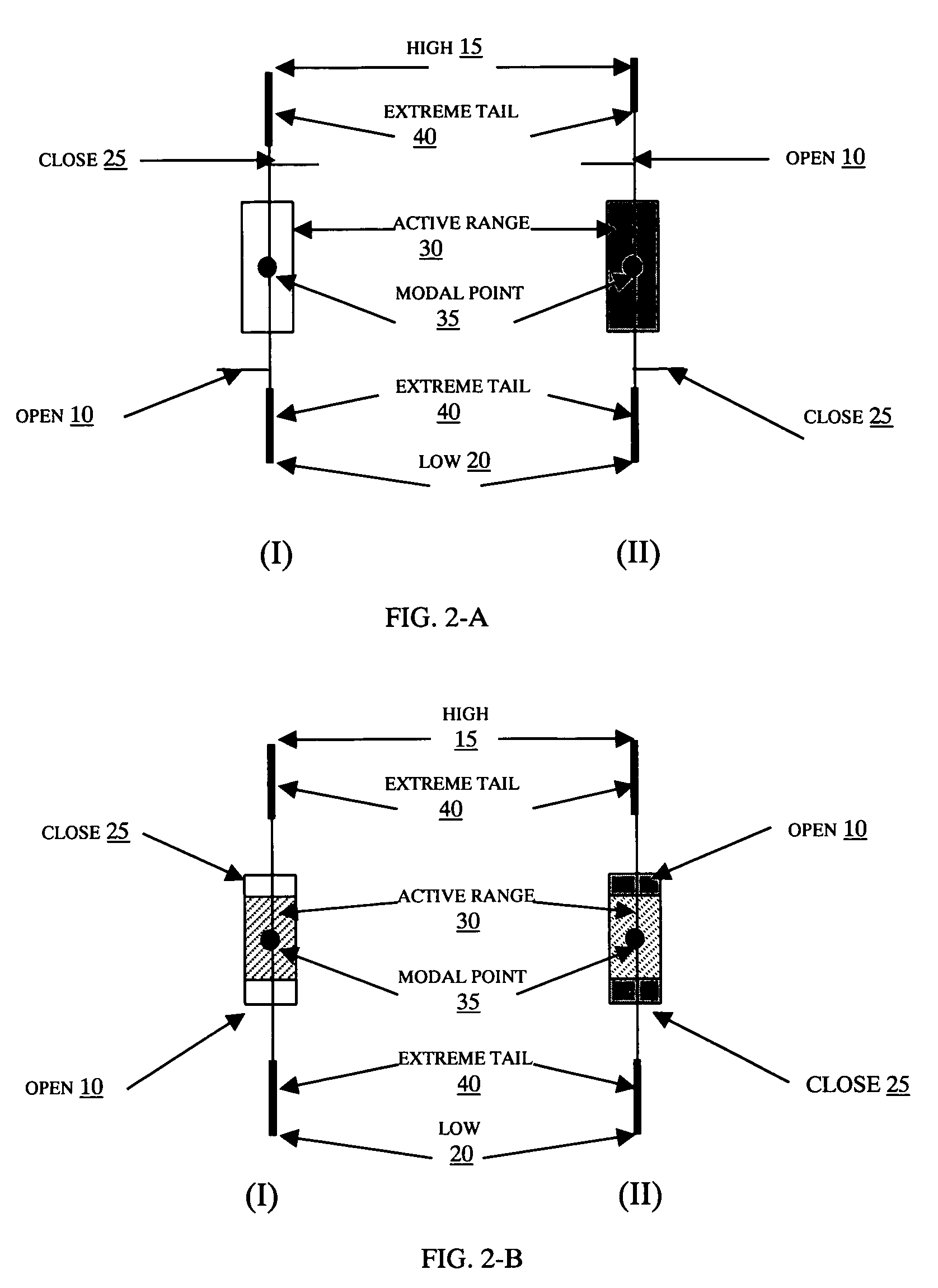

Method for charting financial market activities

A method and apparatus for augmenting the conventional price-time chart used for technical analysis of securities price movements. In a preferred embodiment, the method takes a conventional Bar Chart or Japanese Candlestick Chart with a definite timeframe and then for each bar on the chart; it statistically quantifies the volume and time distribution throughout the range of the bar into discrete elements, using price and volume data within the bar interval from a sub-timeframe. The discrete elements are then graphically overlaid on the bar in a way which preserves its original appearance as close as possible. The apparatus is an application software which implements the method by displaying the conventional price-time chart, calculating the relevant elements and overlaying the values on the chart bars, either in a static or real-time market setting.

Owner:PROSTICKS COM

One touch hybrid trading model and interface

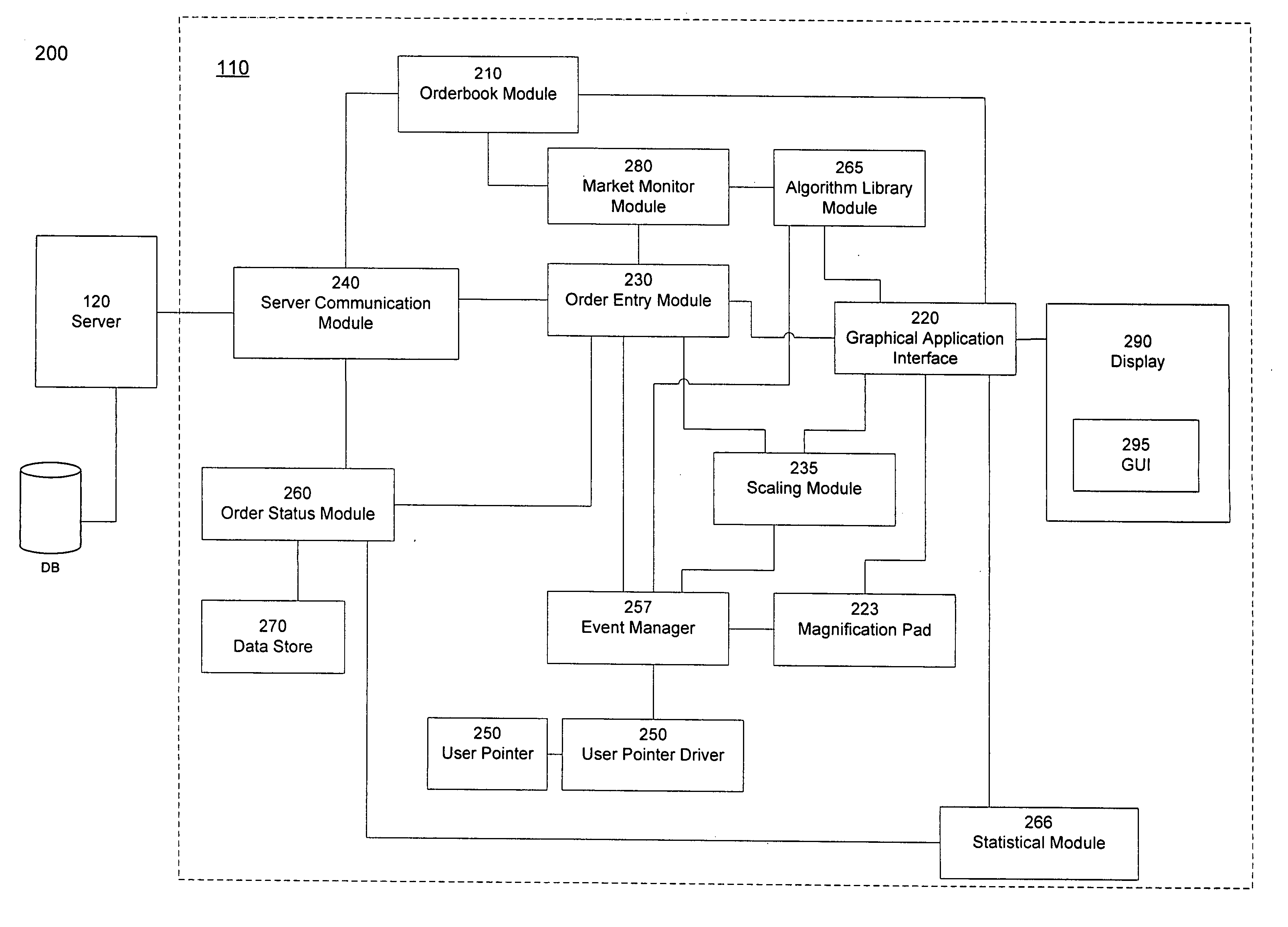

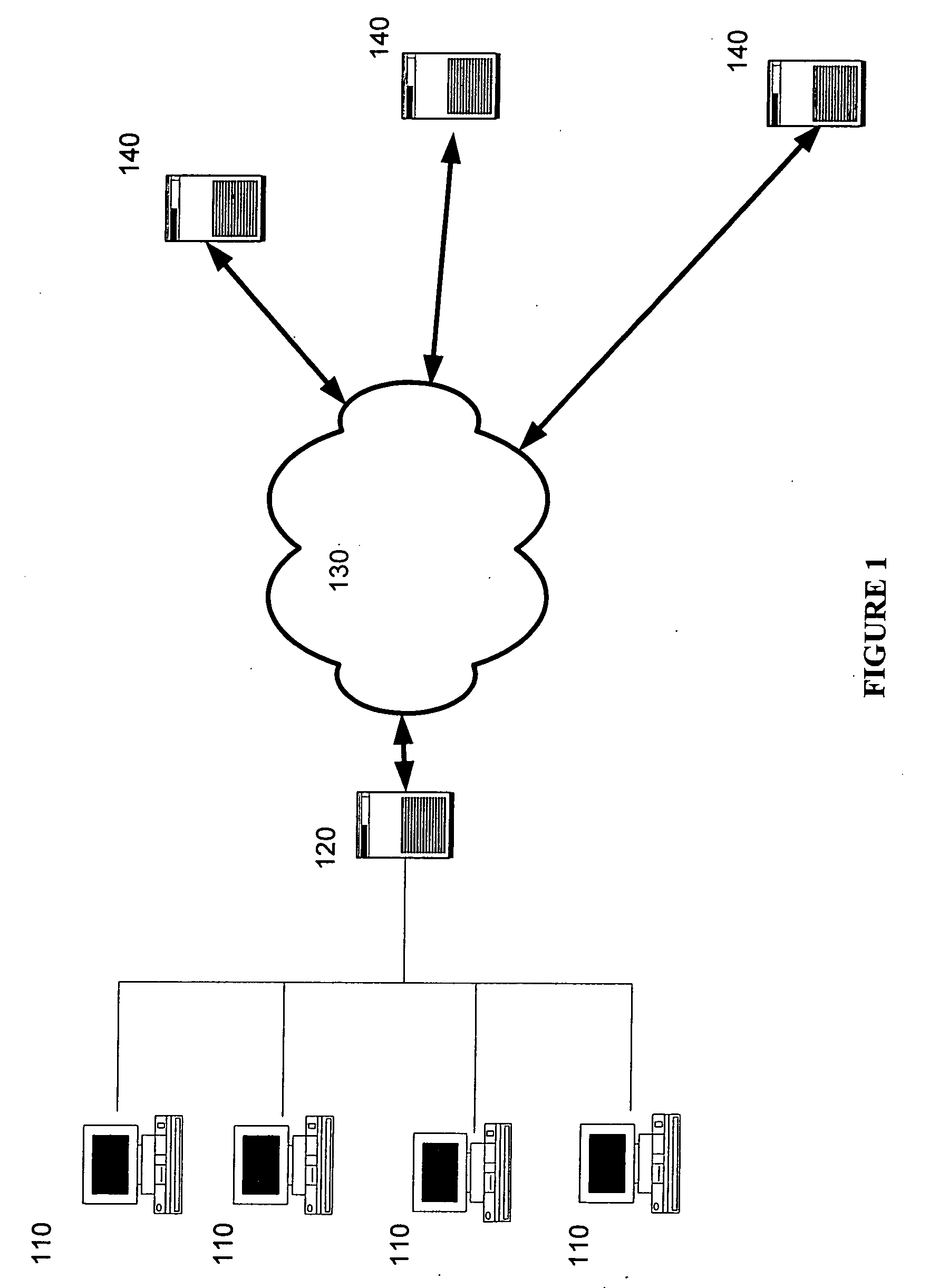

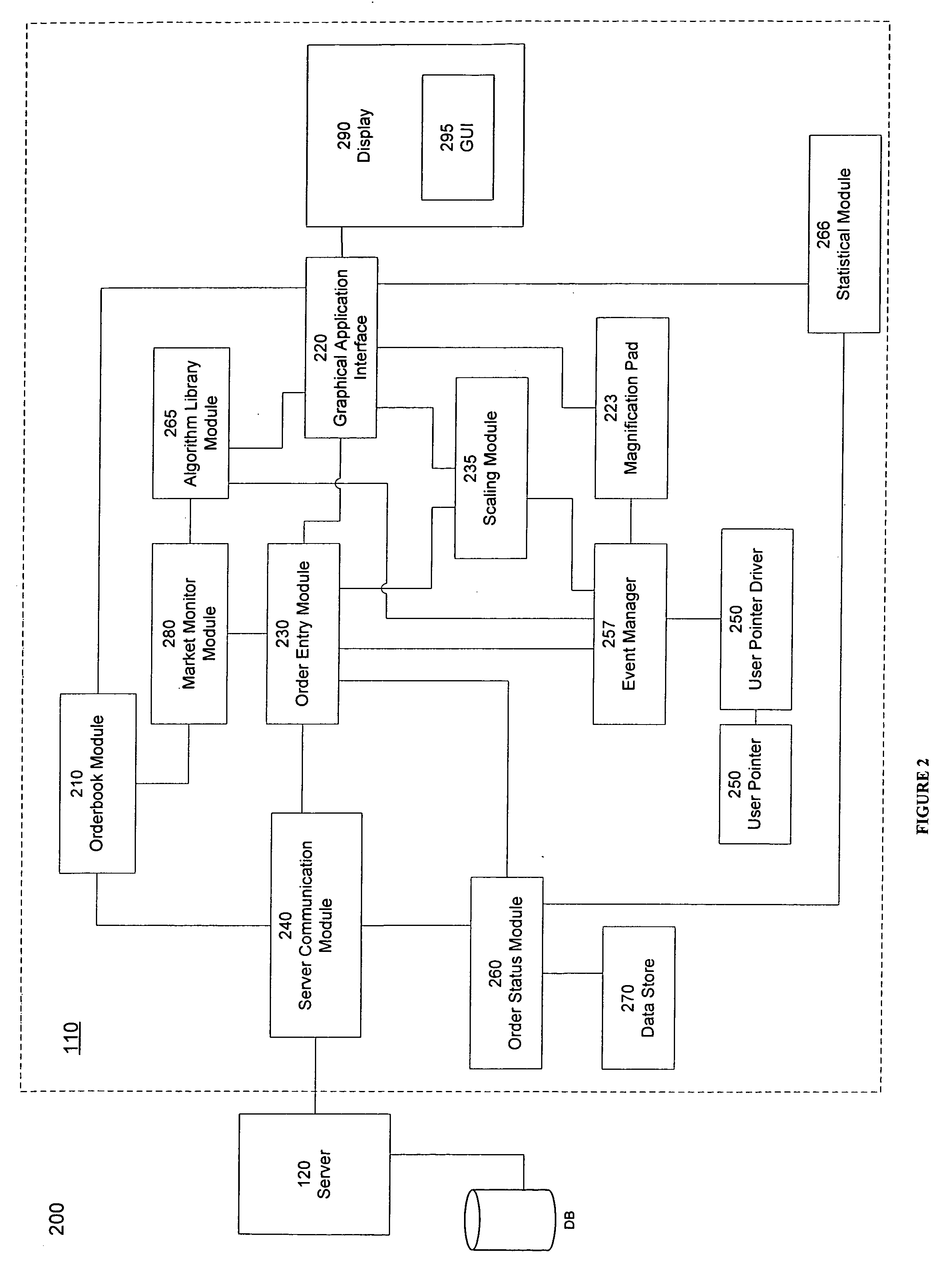

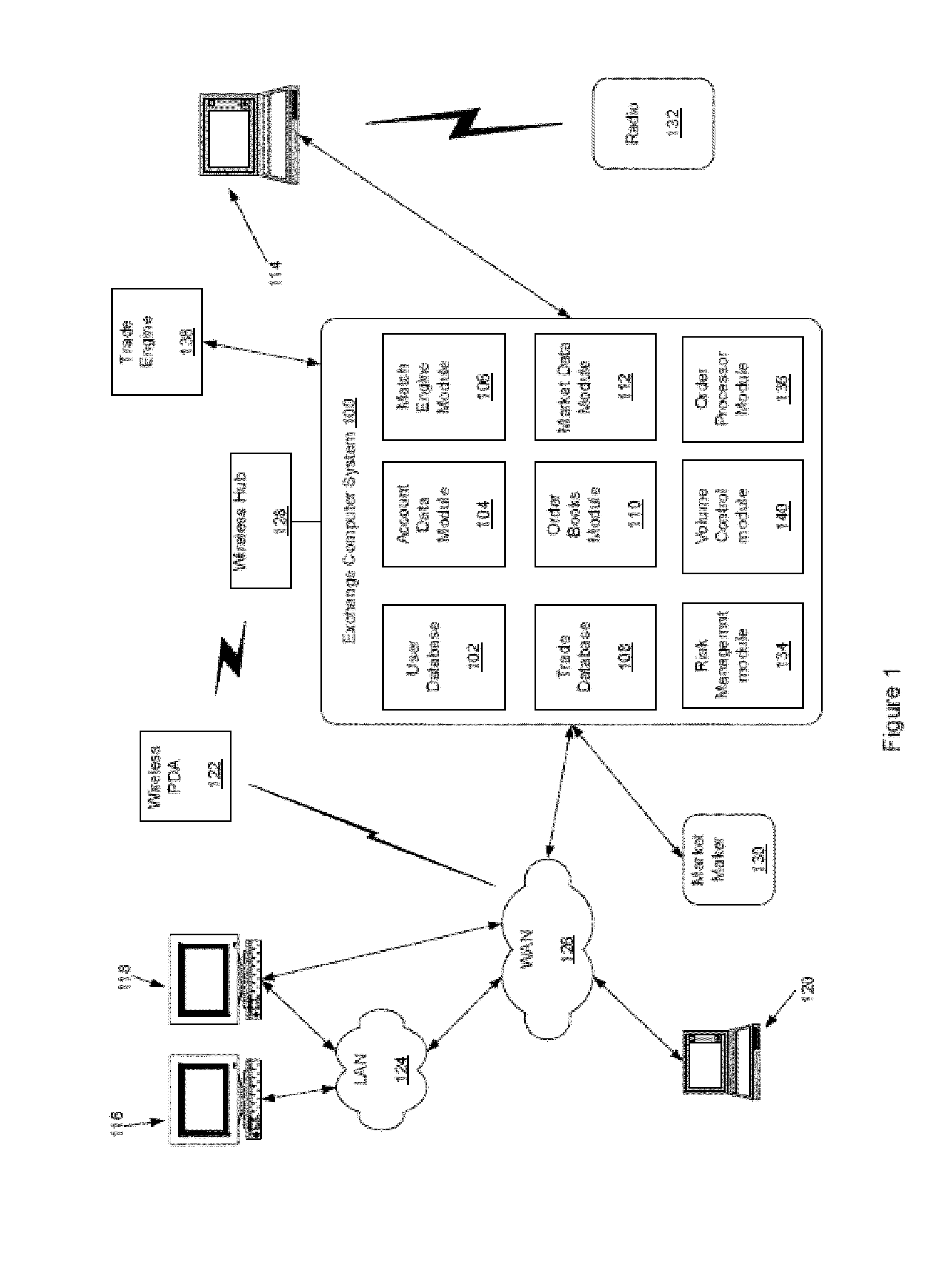

A computer based trading system for trading one or more financial instruments on at least one electronic exchange. The system includes a server connected to a client terminal over a communication network. The client terminal includes a GUI that displays an order book a histogram representing the market activity occurring on at least one of the plurality of electronic exchanges of a specified financial instrument. A user of the system creates and places orders by using a user pointer device coupled with the GUI so as to simultaneously a price and quantity as coordinate pair data corresponding to an arbitrary location of interaction with the GUI based on a user action. The coordinate pair data is available at continuous locations on the GUI.

Owner:WHITE WILLIAM P

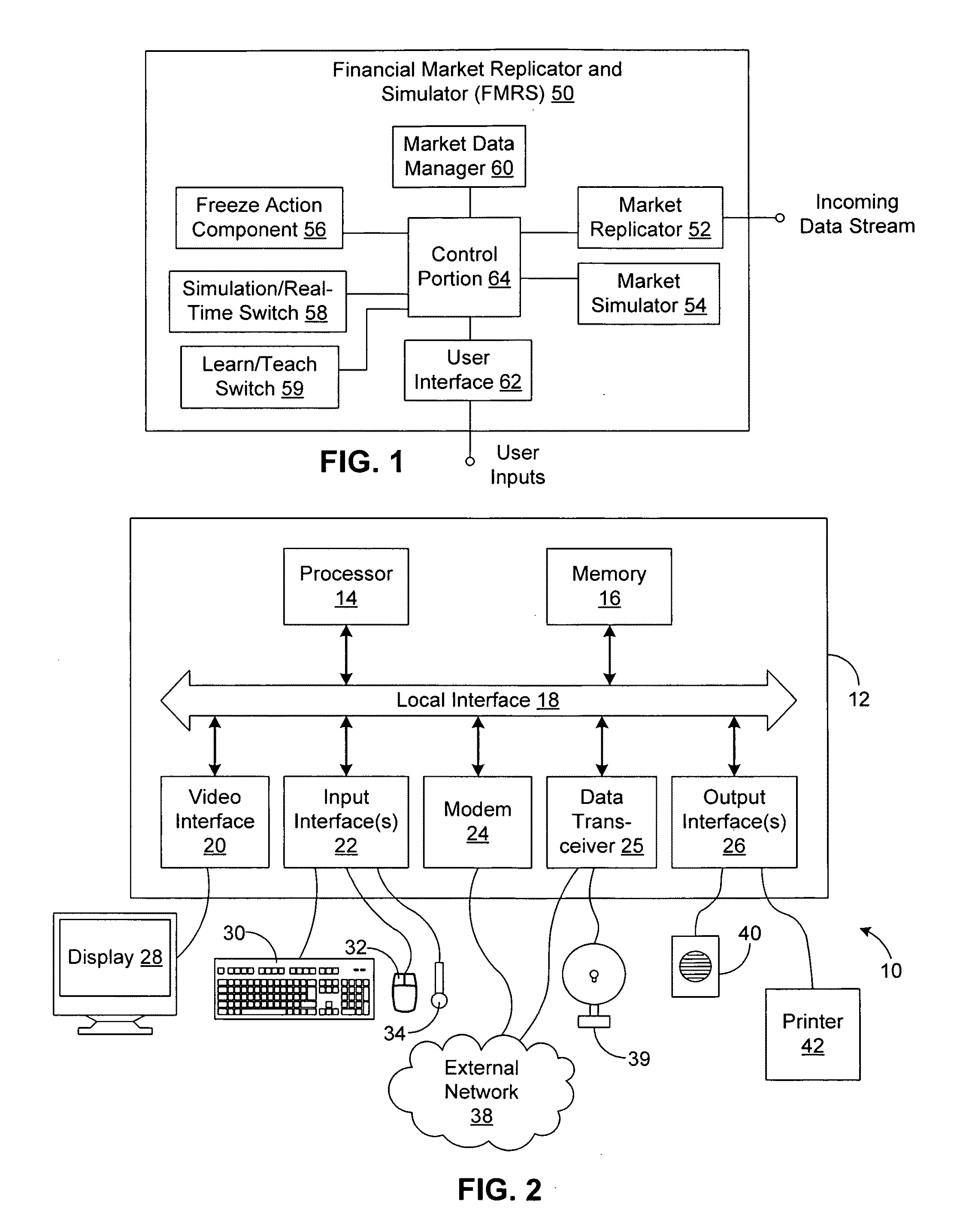

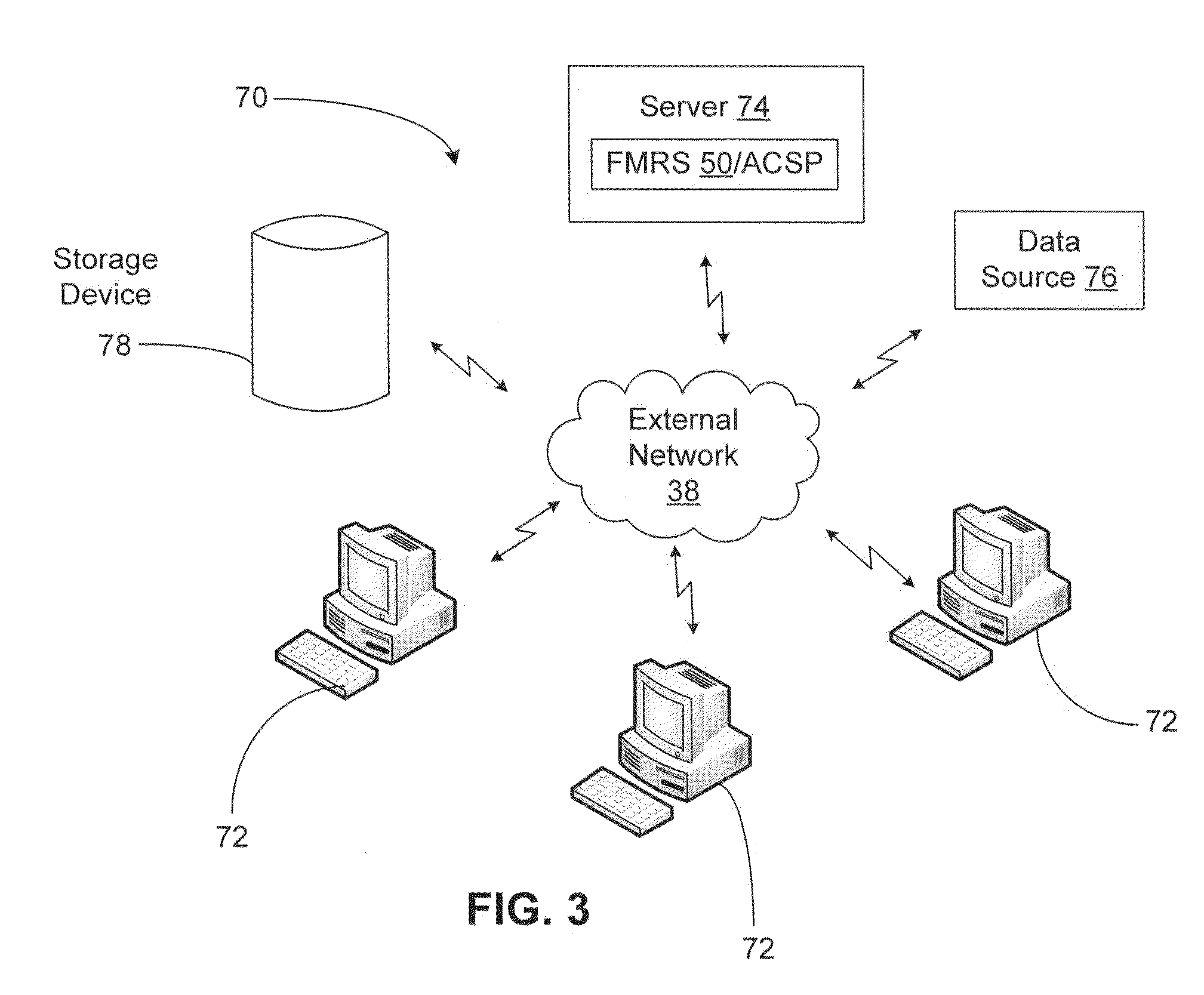

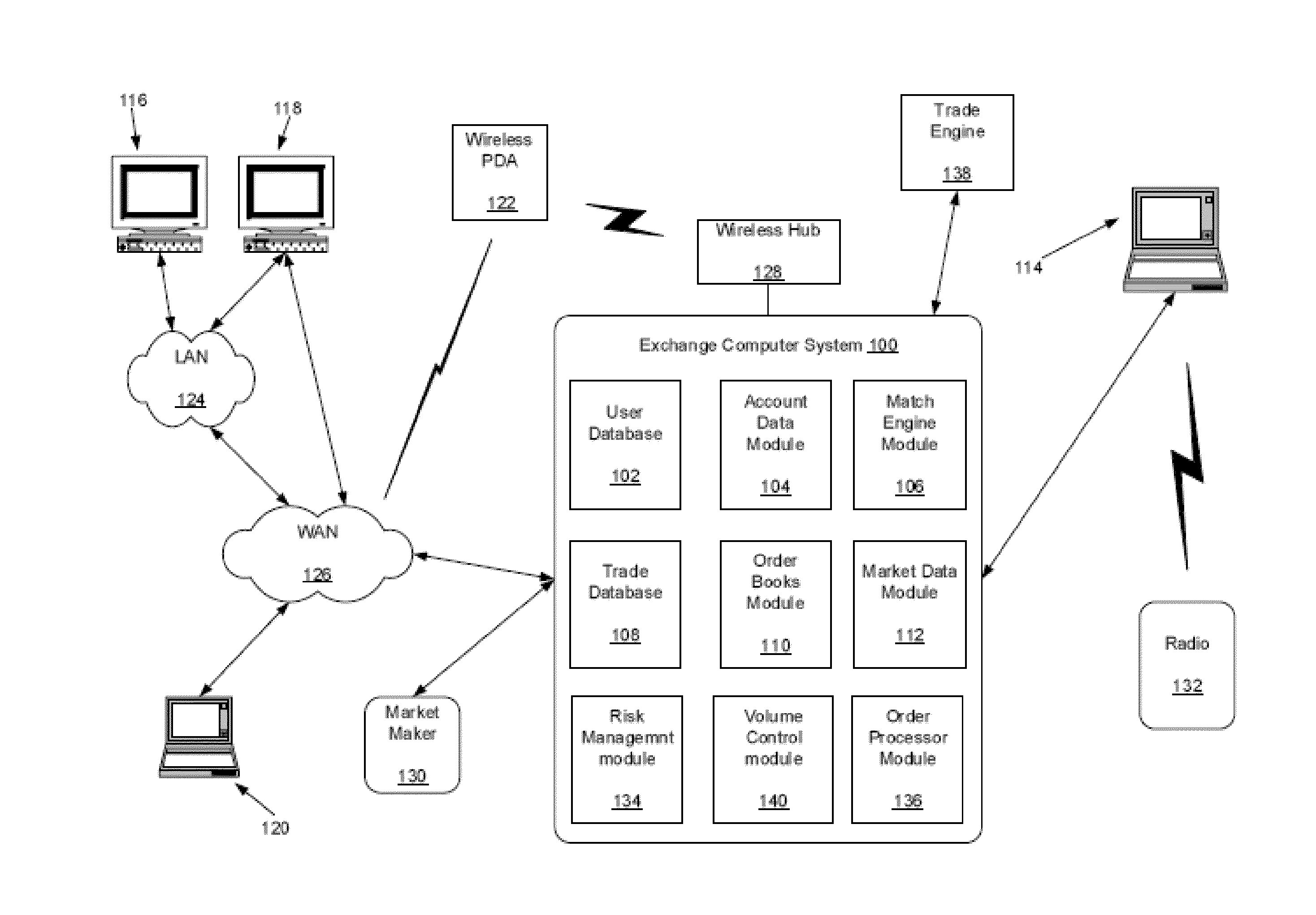

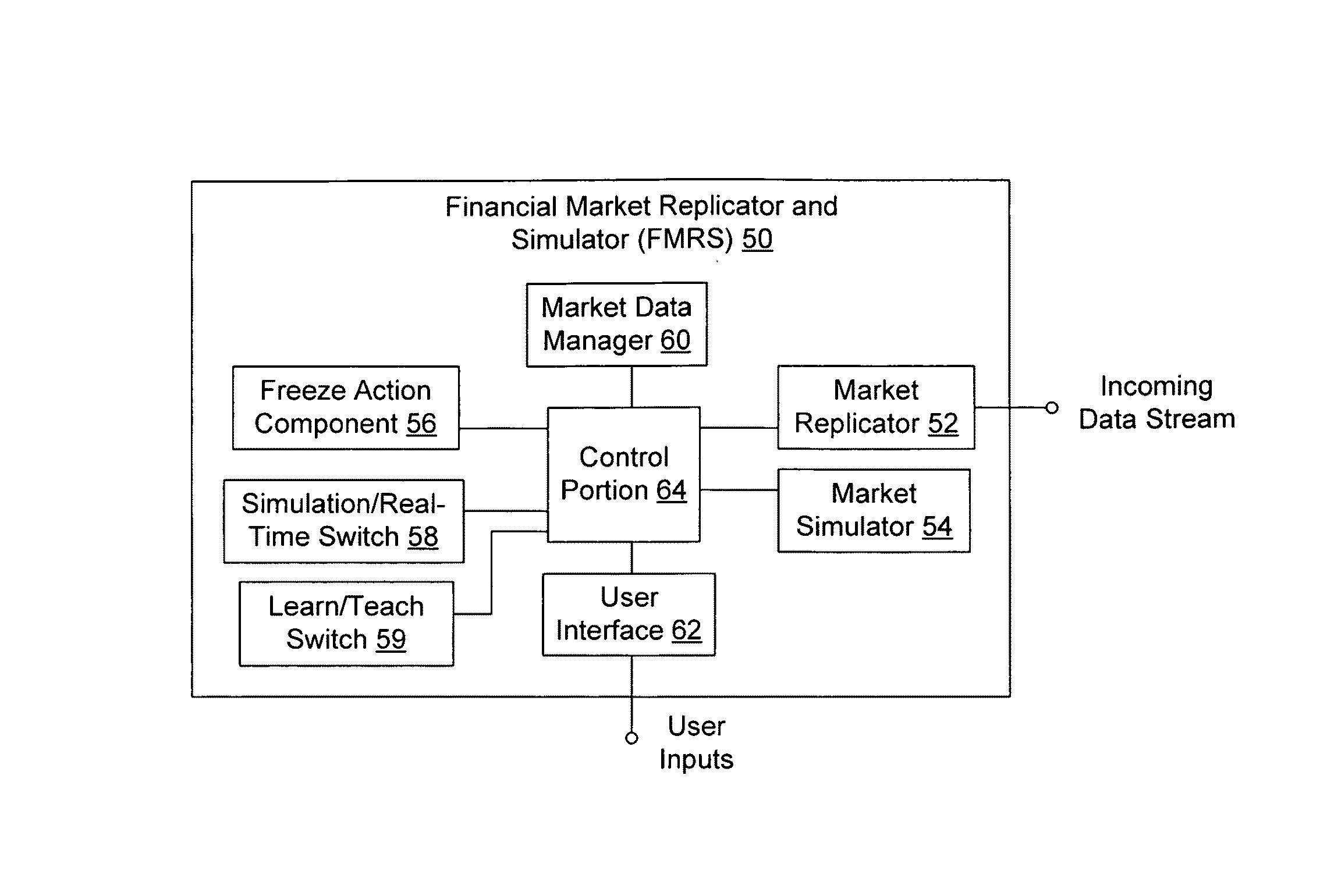

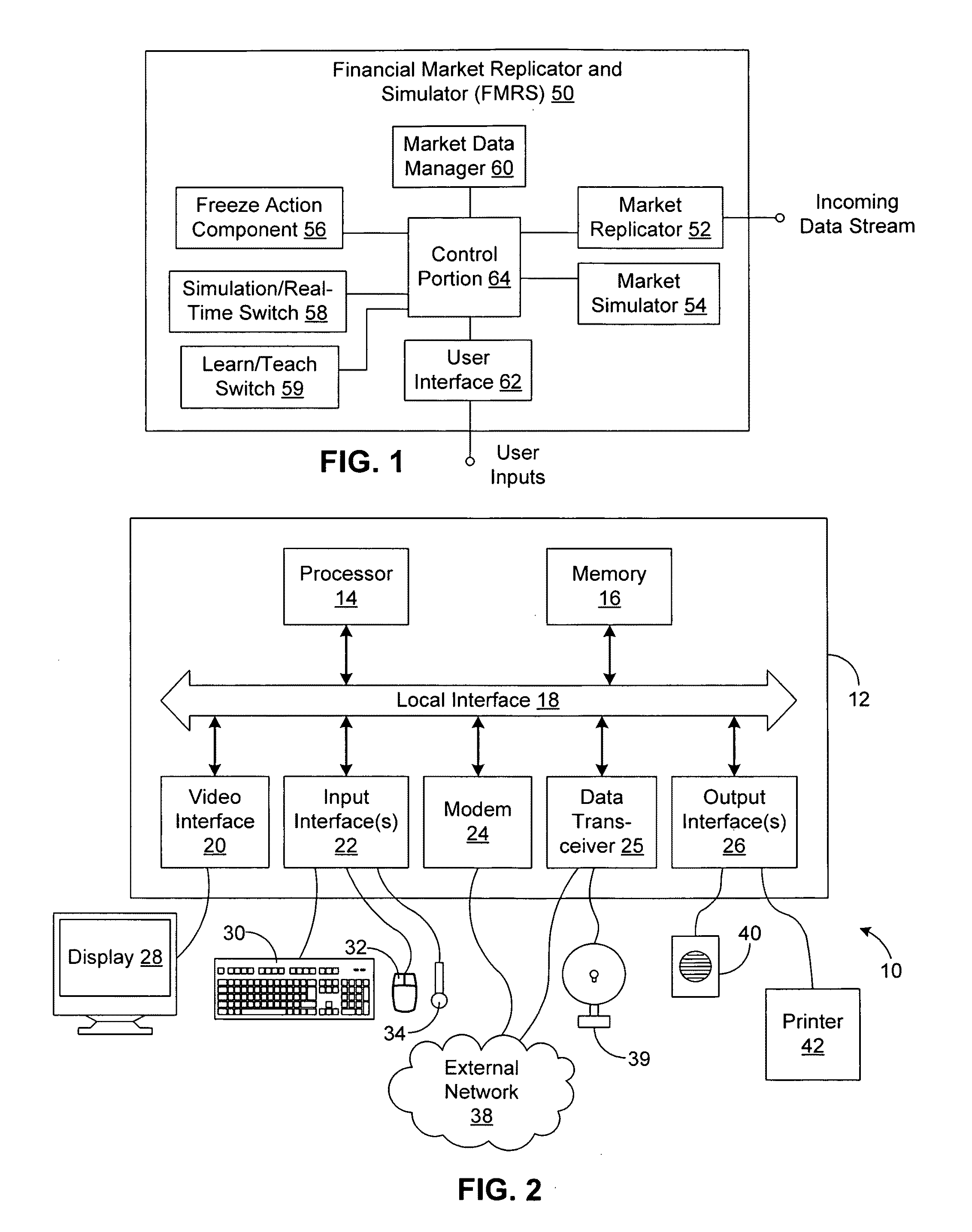

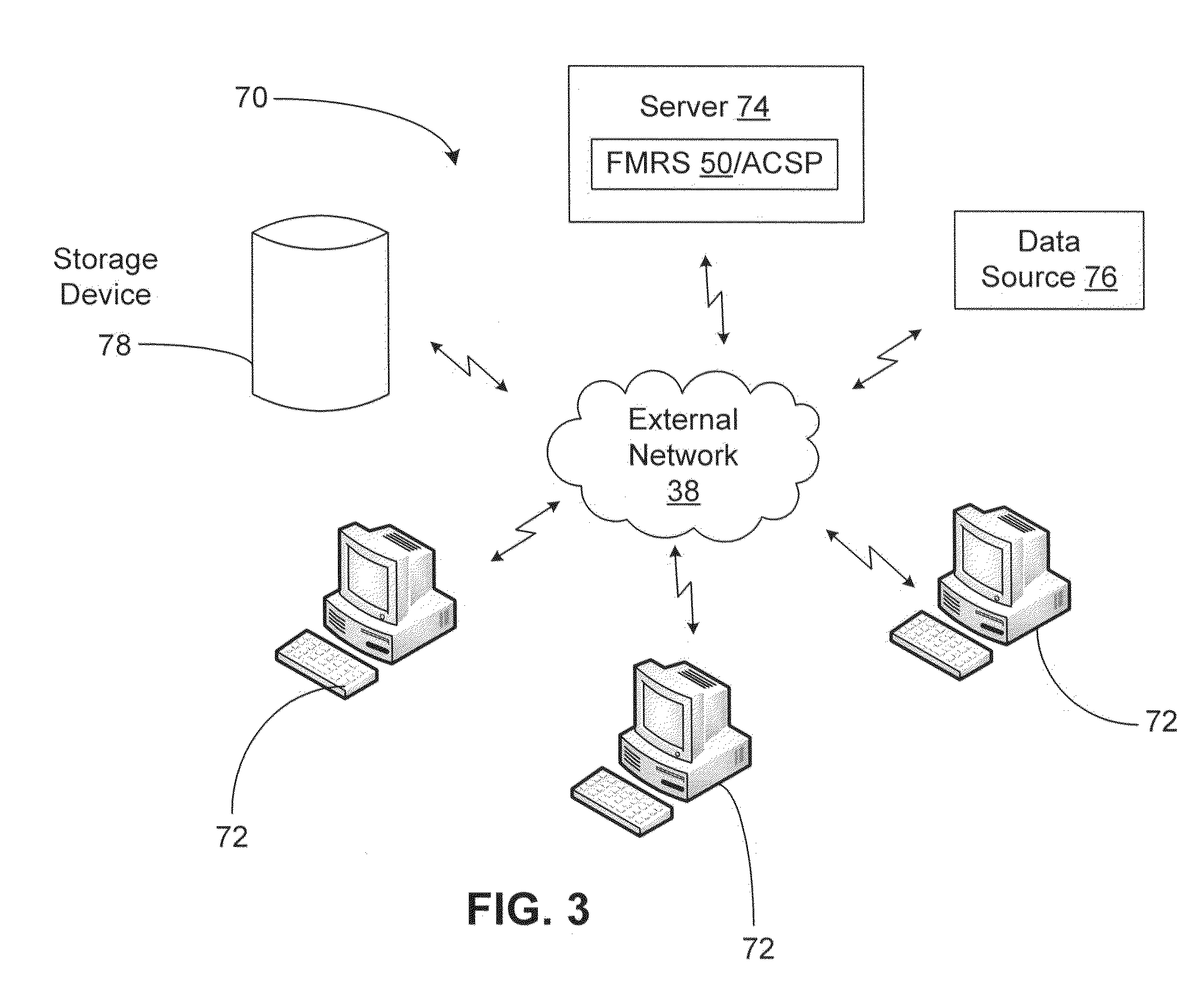

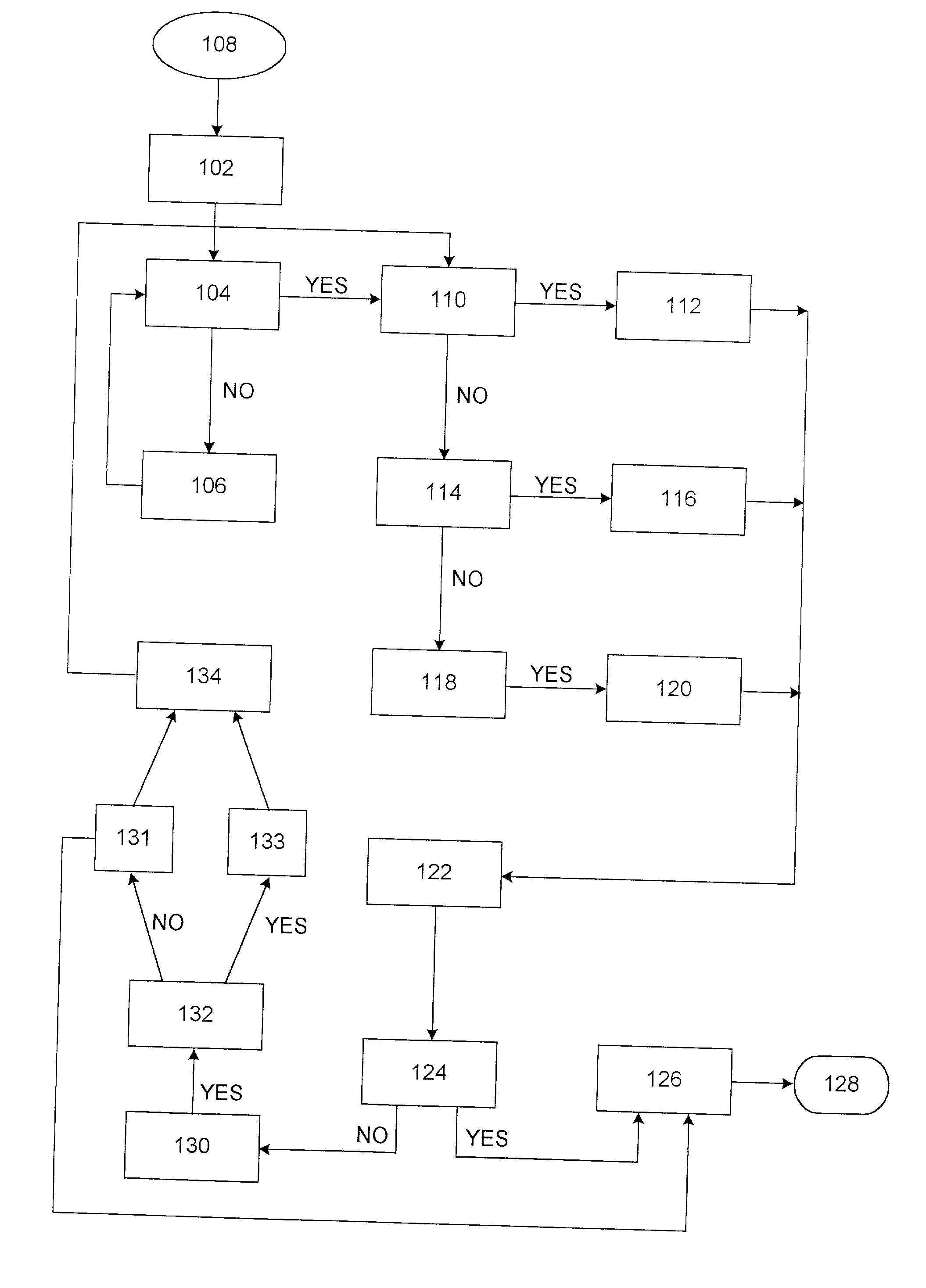

Financial market replicator and simulator

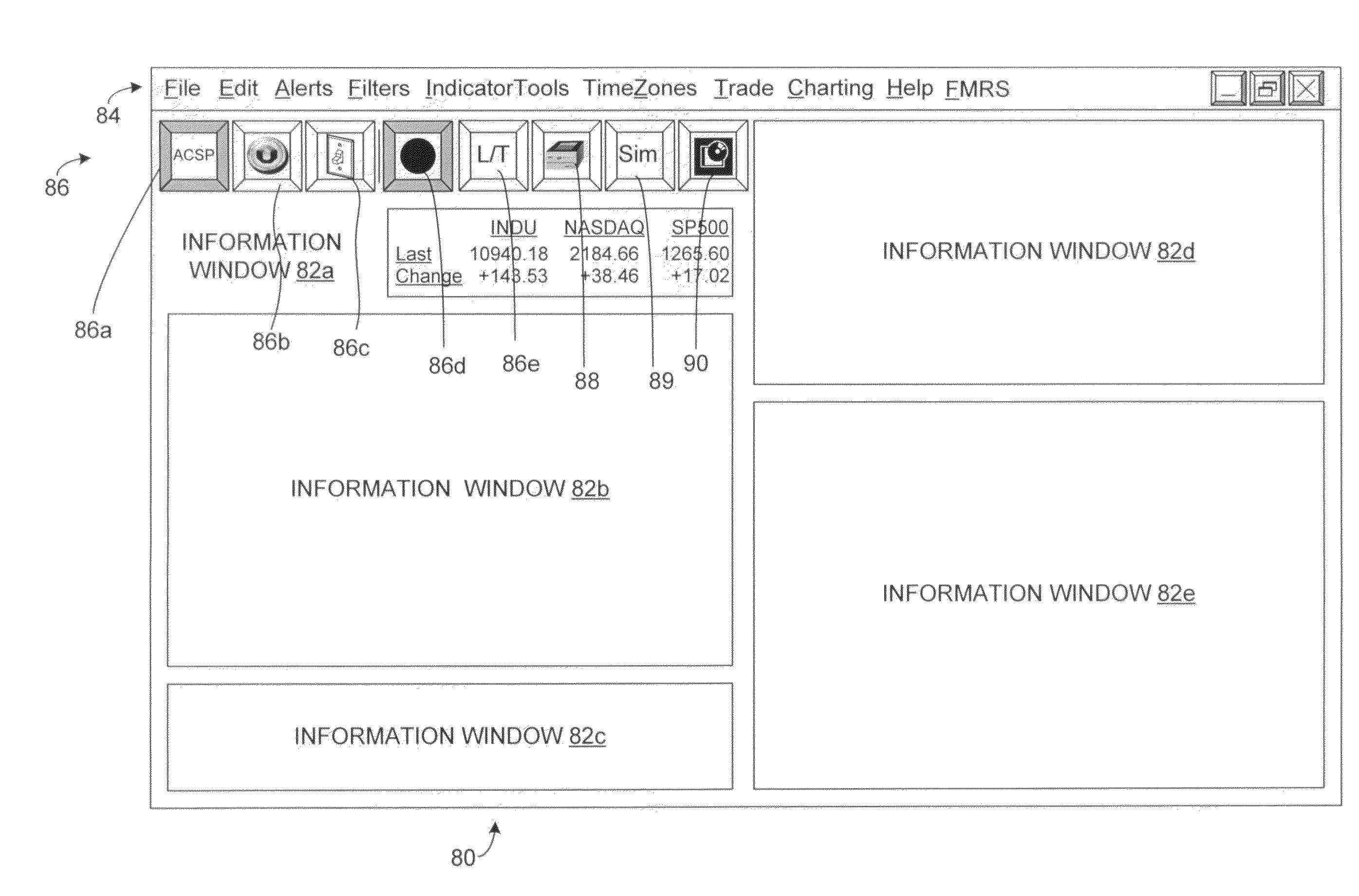

A financial market replicator, simulator, and trainer / annotator (FMRS) intermixes and records data streams of real time financial market data from a variety of sources. The FMRS replays such recorded data to simulate the real time financial market(s) in a manner that represents substantially the entirety of information relating to the financial market(s) such that an observer would have difficulty differentiating between the simulator playback of the data and real time data. A user may employ the playback of the recorded market data stream as a research and training tool for developing and executing trading strategies. For example, a user may input simulated trades of securities to test a trading strategy. The simulator would apply those trades to the recorded data to generate simulated trades and simulated profit and loss results. A user may then determine if the trading strategy would have been successful. In addition, a user may alter the recording and playback parameters to provide various opportunities for studying market activity and / or altering the level of challenge of the simulation. A user may also freeze the simulator playback in order to explore the interactive and collective behaviors of the market's participants and the securities they trade.

Owner:ADVANCED INTPROP GROUP

Multiple open order risk management and management of risk of loss during high velocity market movement

The disclosed embodiments relate to a mechanism which may restrict or otherwise manage the extent of exposure of any particular market participant within the price movement threshold of a market protection system which interrupts market activity during extreme events, as well as to a mechanism for controlling risk of loss which acts to reduce or otherwise manage a market participant's ability to concentrate their exposure, or risk of loss, within a range of price levels and / or within correlated products that could be executed upon before the market participant, or other entity responsible for the activities thereof, e.g. a risk manager, has an opportunity to react to rapid market movement. Such a mechanism, once the market protection system had activated, e.g. by placing the market in reserve, may permit the market participant, or other party, the opportunity to modify or cancel unexecuted orders to mitigate potential losses.

Owner:CHICAGO MERCANTILE EXCHANGE

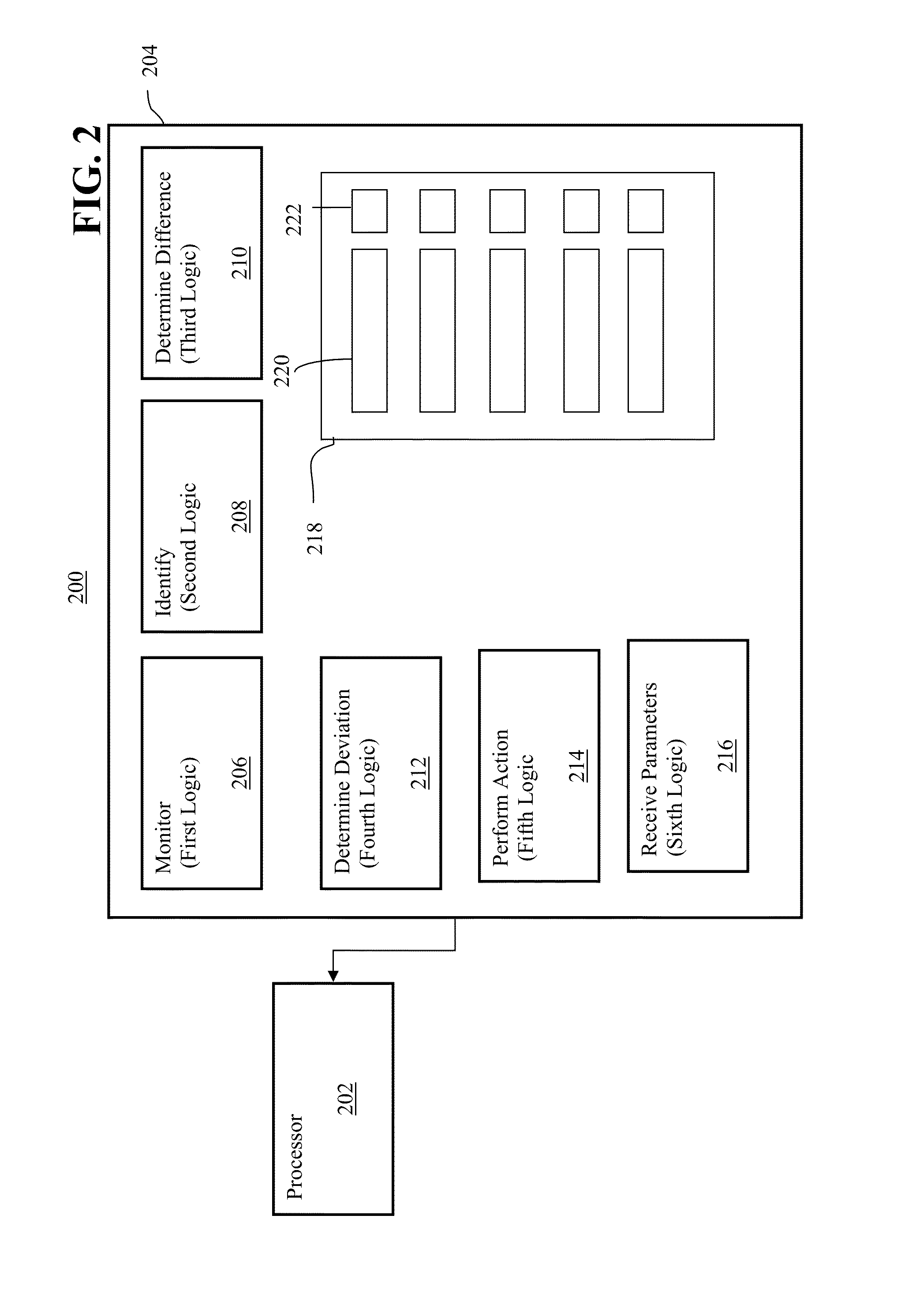

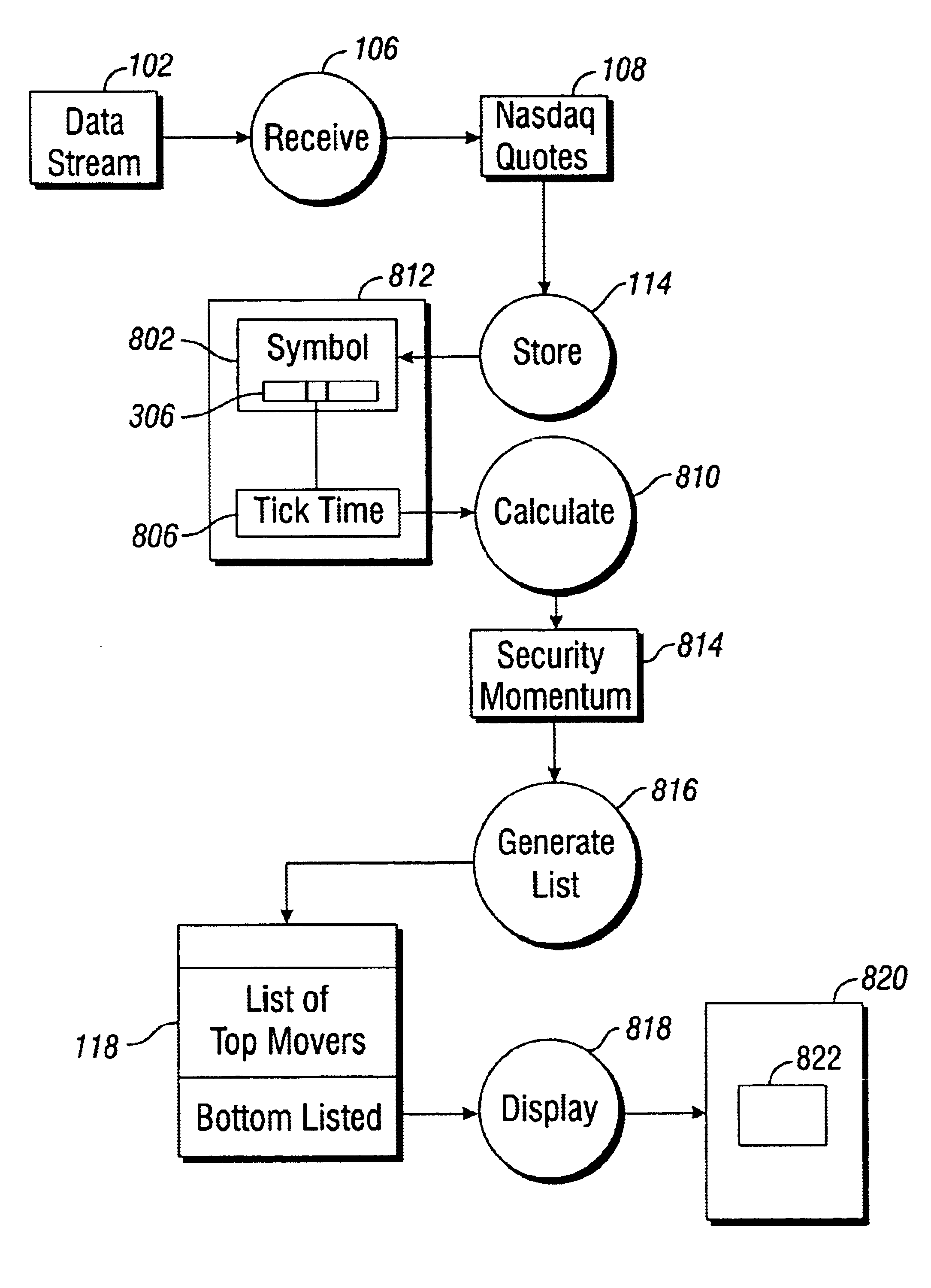

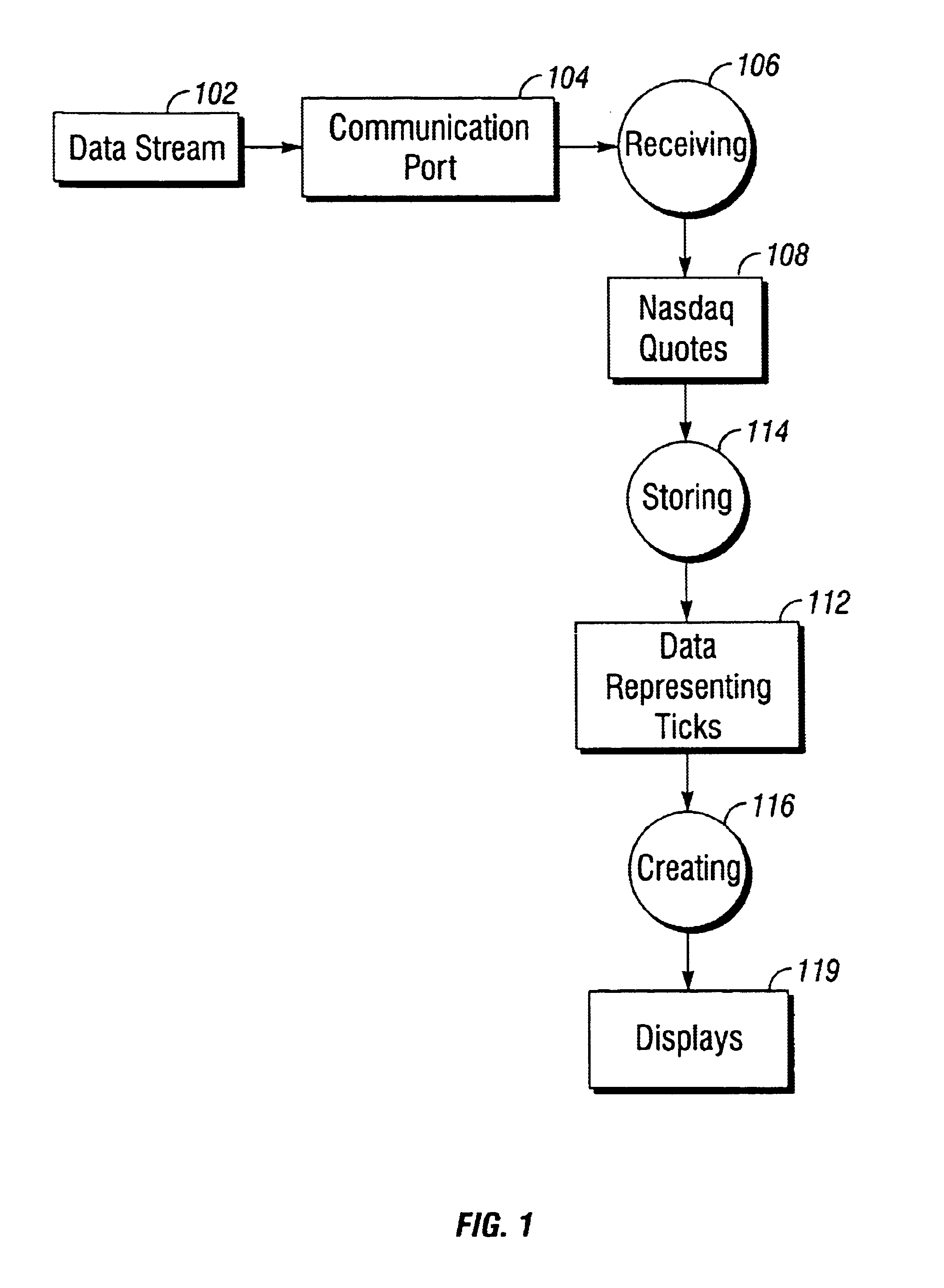

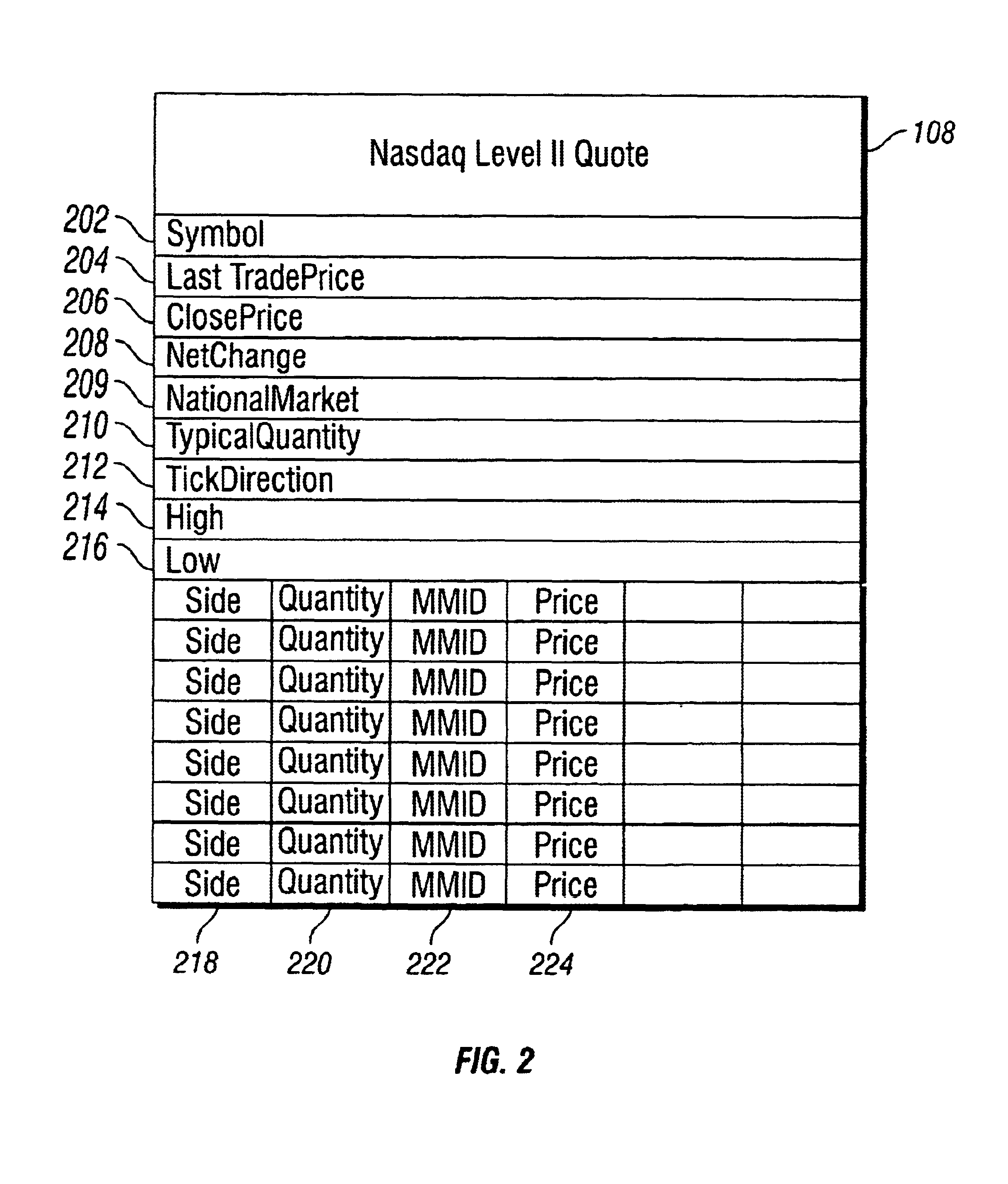

Apparatus and method for automated display of market activity

Thermographs and top mover lists as displays of market motion. Displays for time-dependent information. Thermographs comprising display areas on computer screens, the display areas divided into cells, tick times for a security stored in memory, color values calculated for each tick time and displayed in contiguous cells in the display area. Lists of top moving securities identified by calculation of security momenta comprising differences between a current time and tick times, the differences being summed.

Owner:MORGAN STANLEY +1

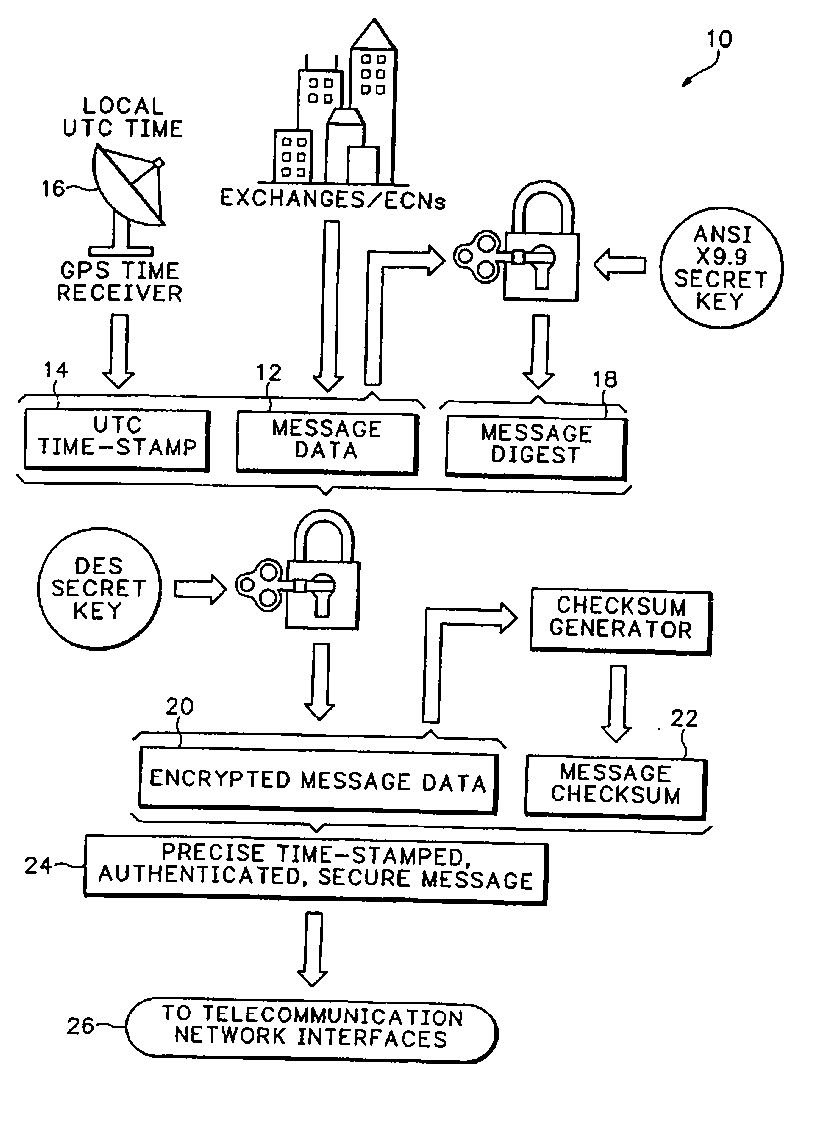

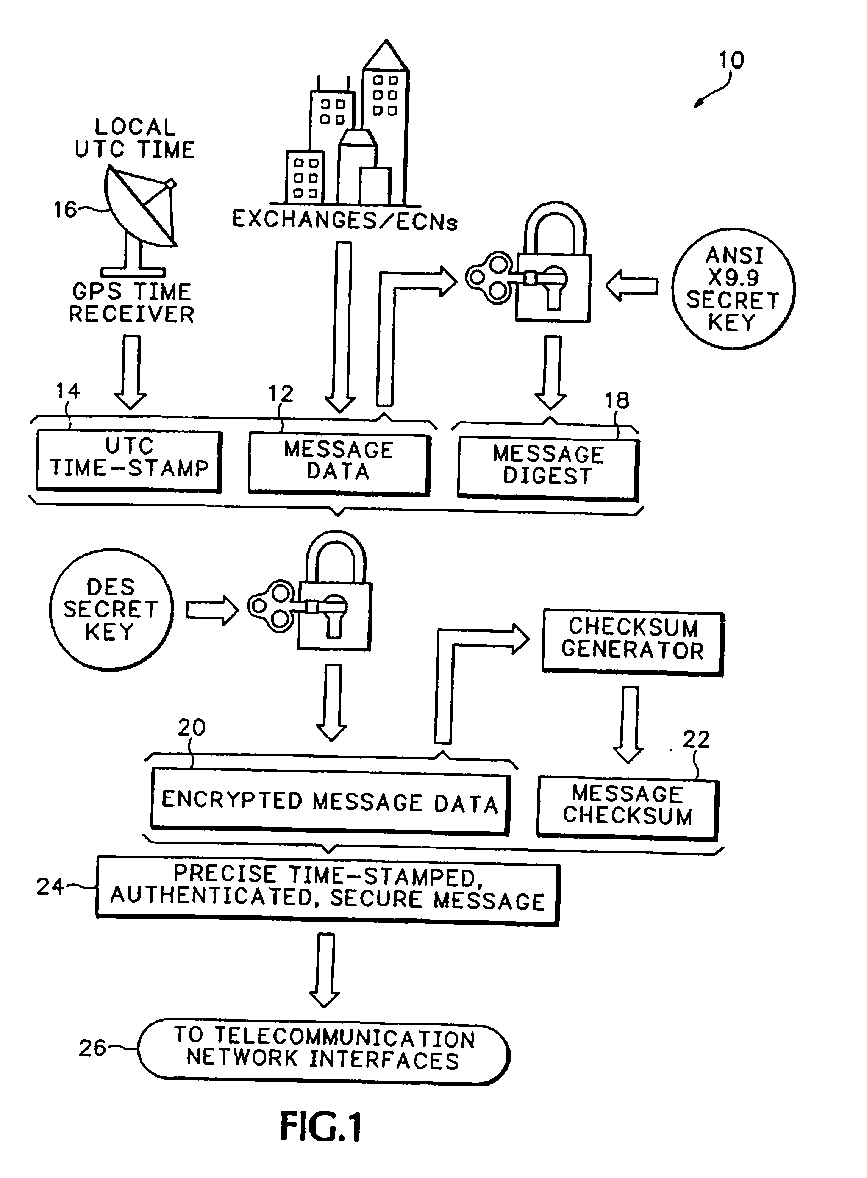

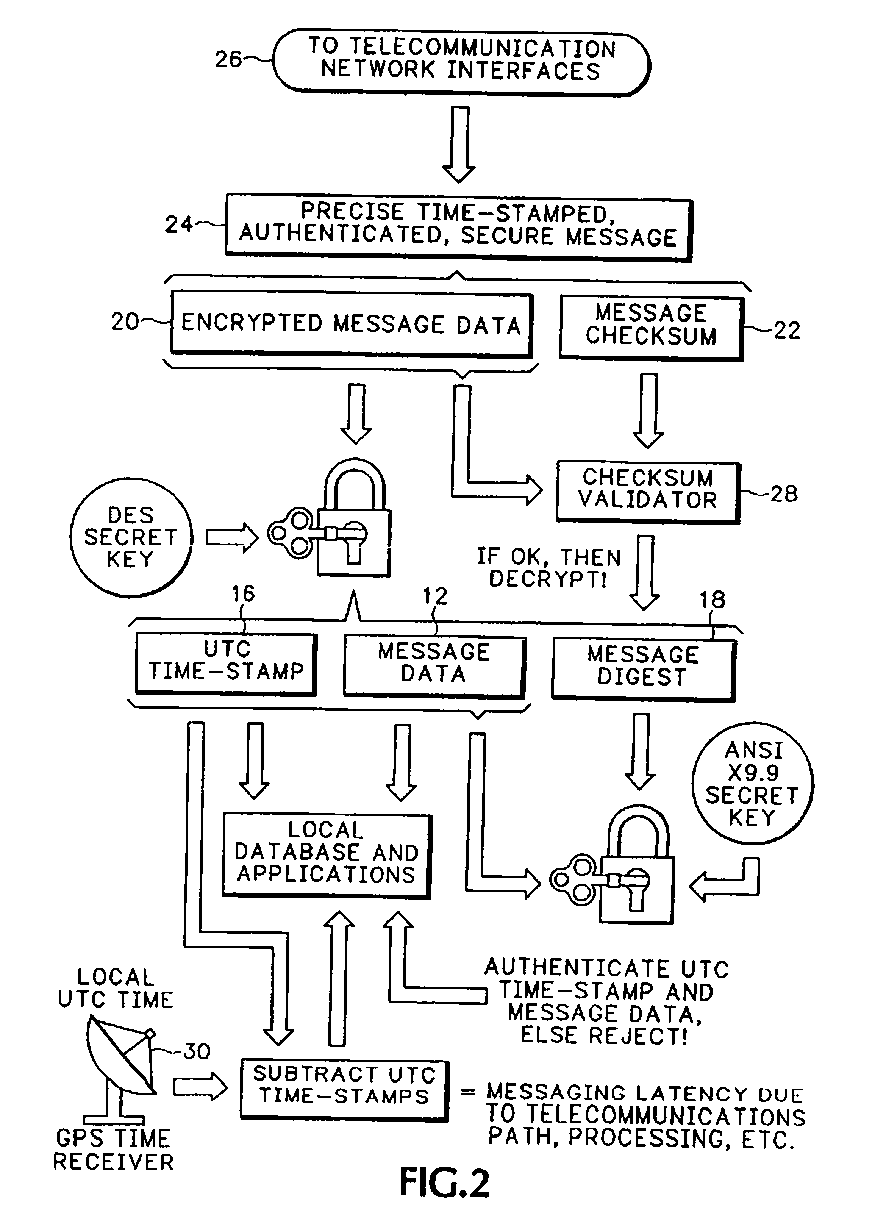

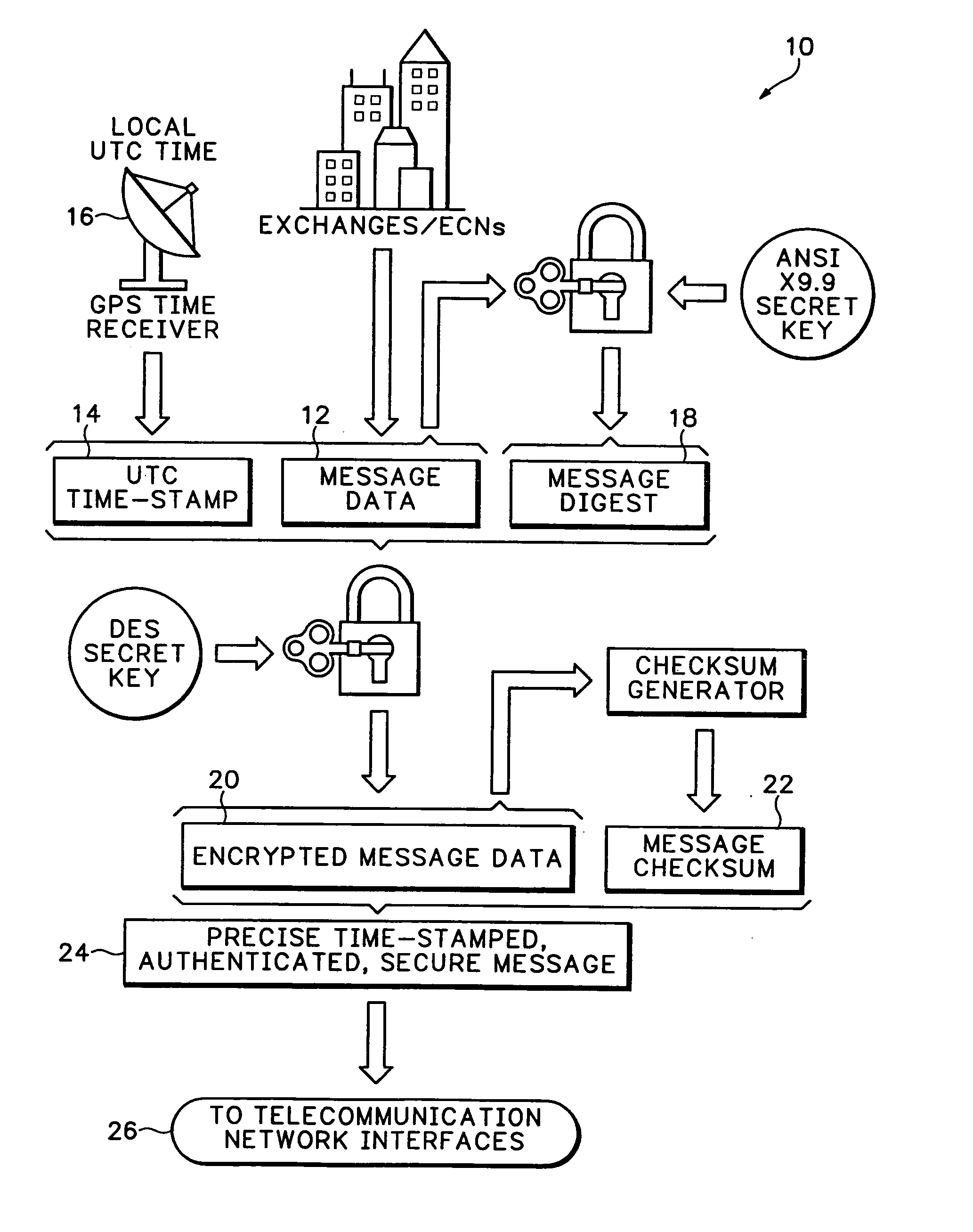

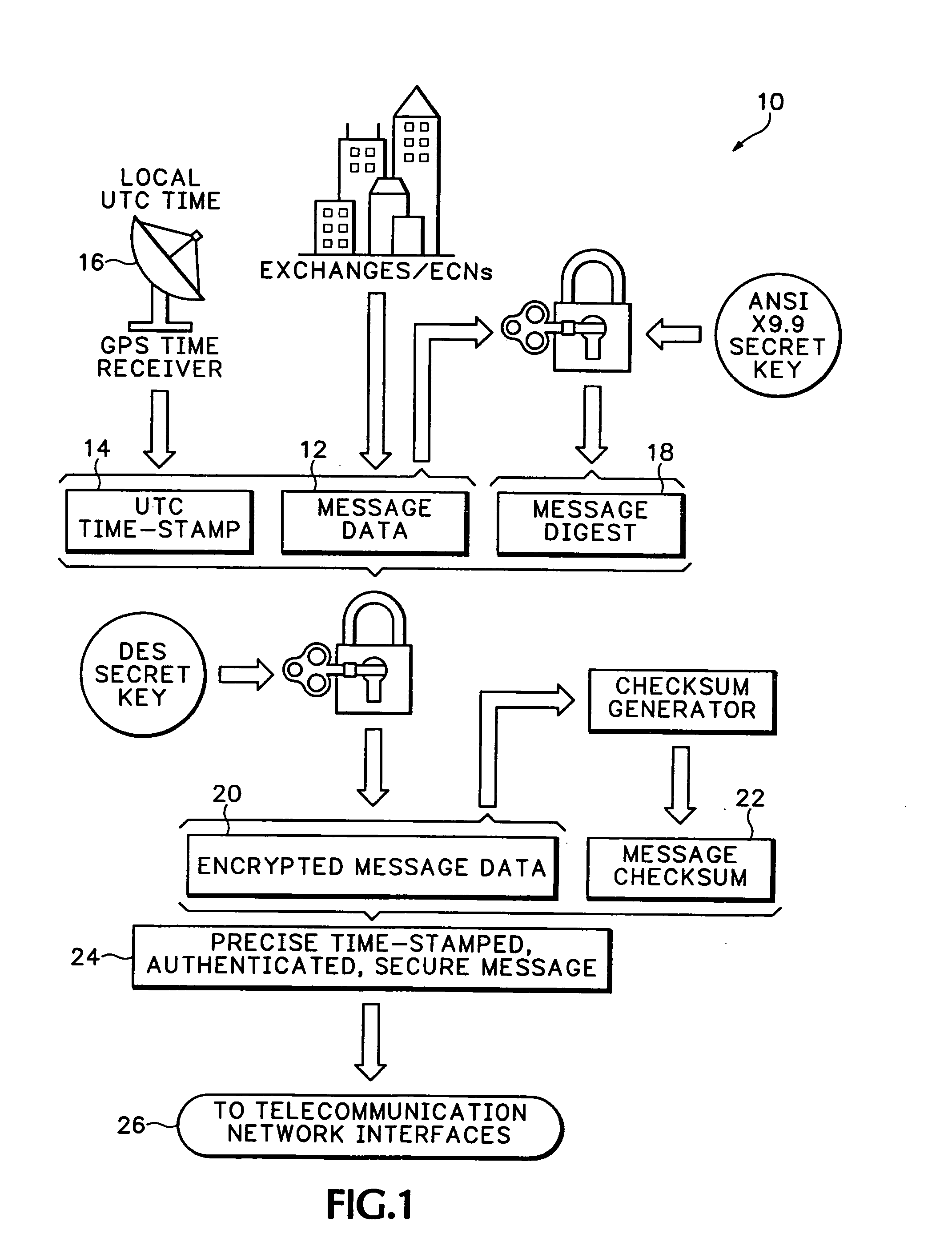

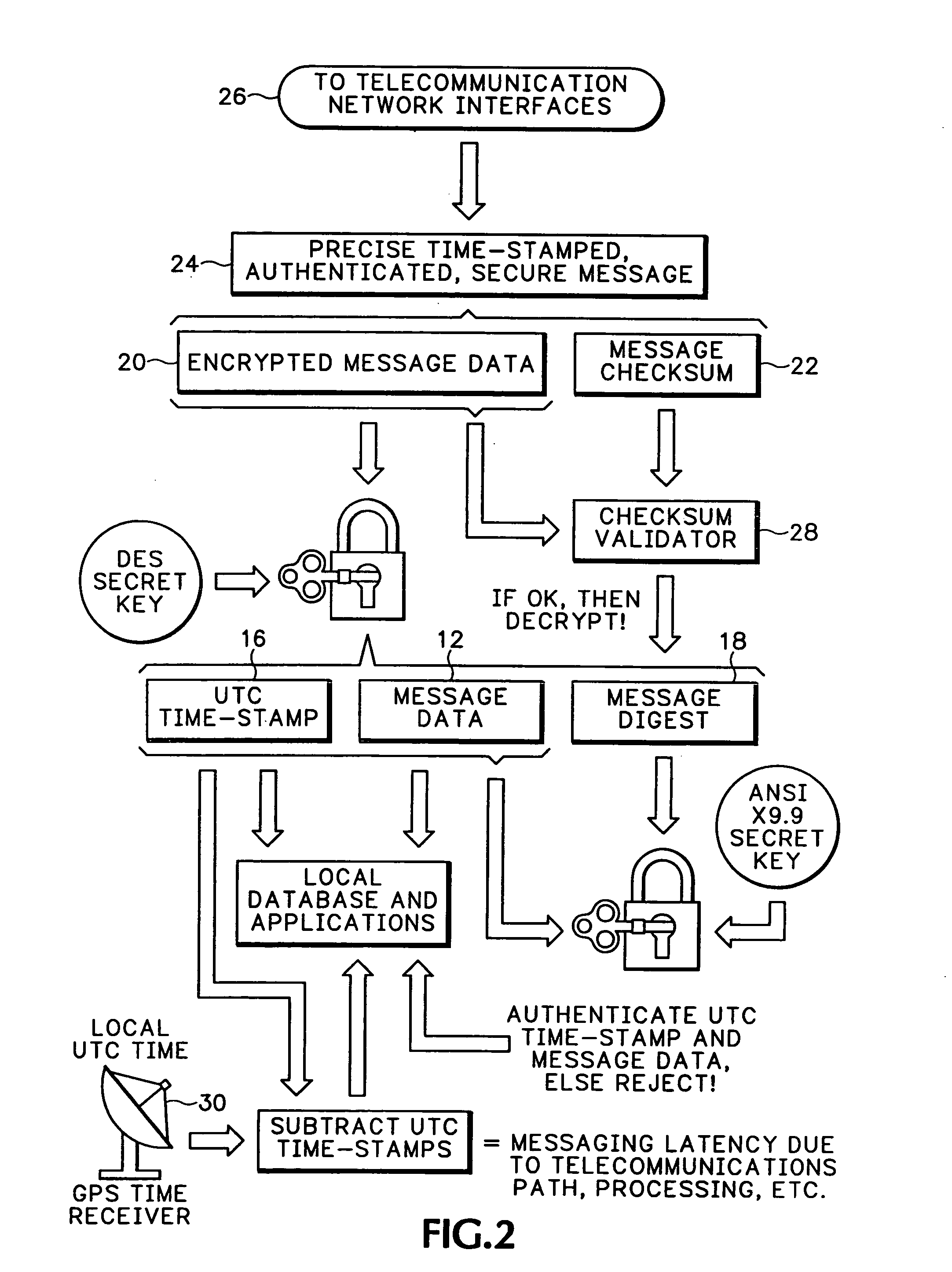

Method and apparatus for measuring network timing and latency

Owner:TIMEDATA PARMJIT S KANG

Method and apparatus for measuring network timing and latency

A method and system for time stamping and authenticating packets of financial data, like orders to buy or sell and confirmations of such orders and resulting trades. The packets are stamped and encrypted multiple times as they enter and leave communications networks and during market processing. Market data, including information about all of the orders and trades generated at the market, is likewise time stamped and distributed to subscribers. This resulting timing data can be used in an algorithmic trading application to make trading decisions. When multiple markets are so equipped, an accurate time-aligned database of market activity may be utilized to develop algorithmic trading applications or for forensic purposes. Packets can also be rerouted or switched to a private network for multicasting to subscribers. The packets are processed to preserve proper handling by downstream routers and switches even though timing data is added to the application layer.

Owner:TIMEDATA PARMJIT S KANG

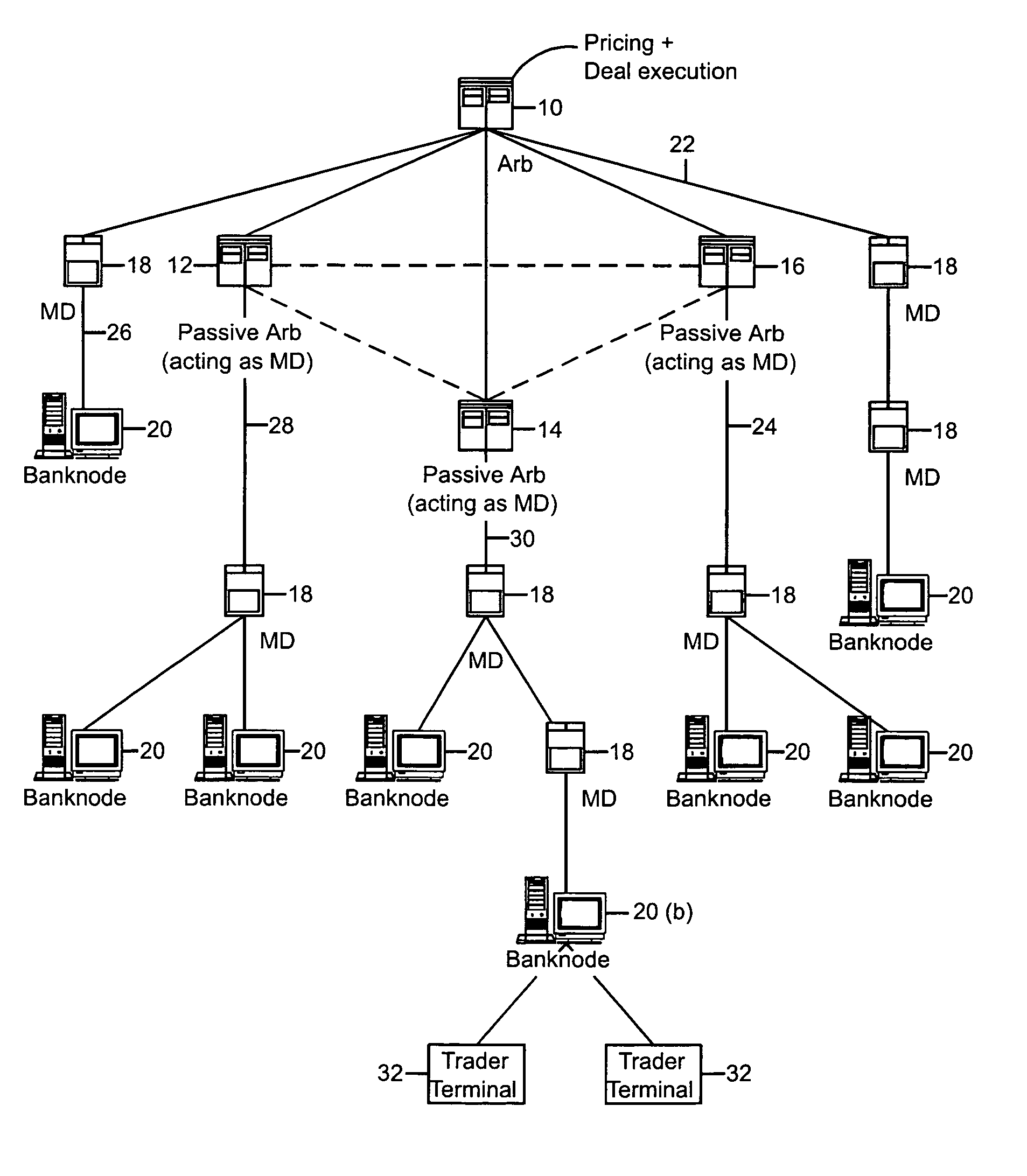

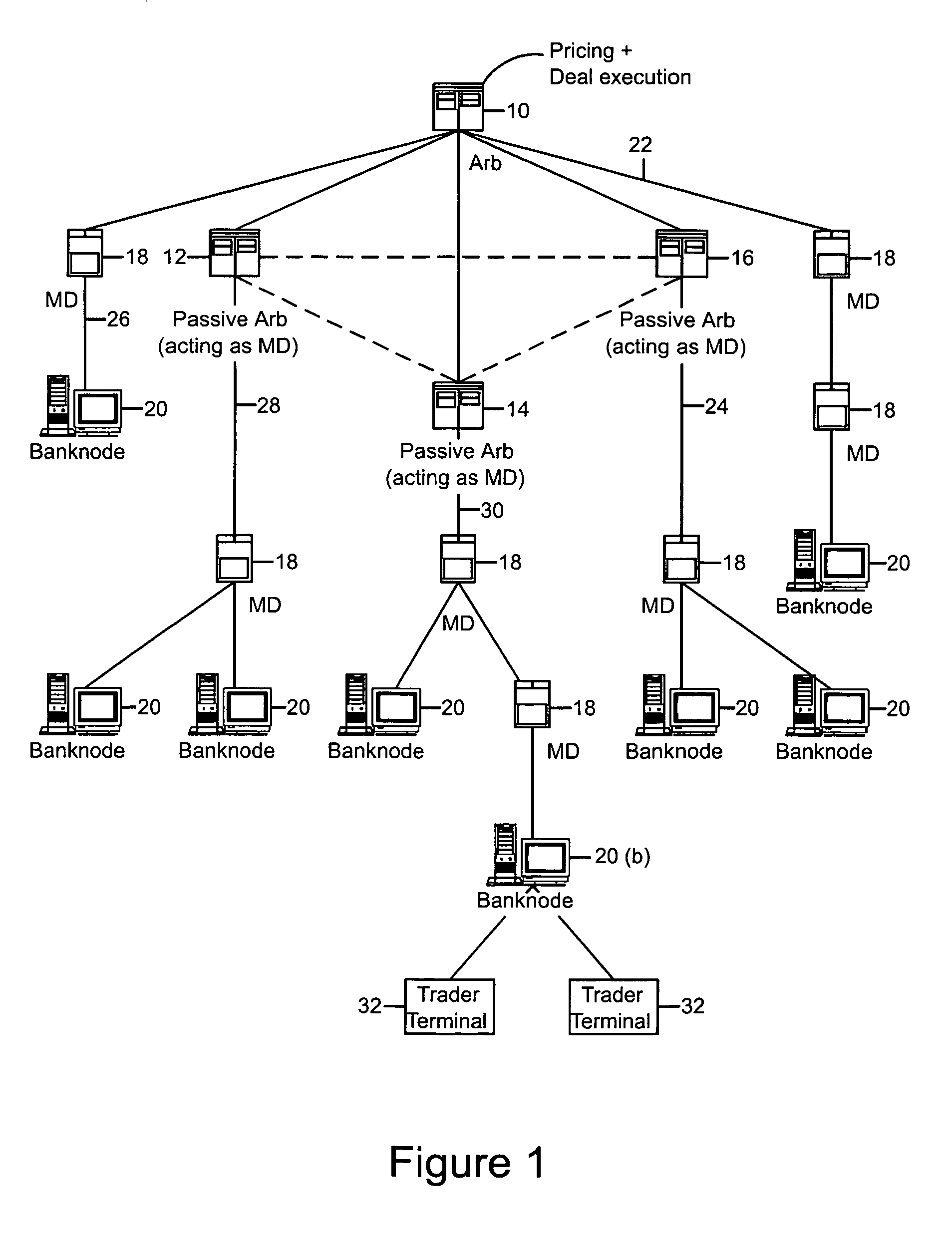

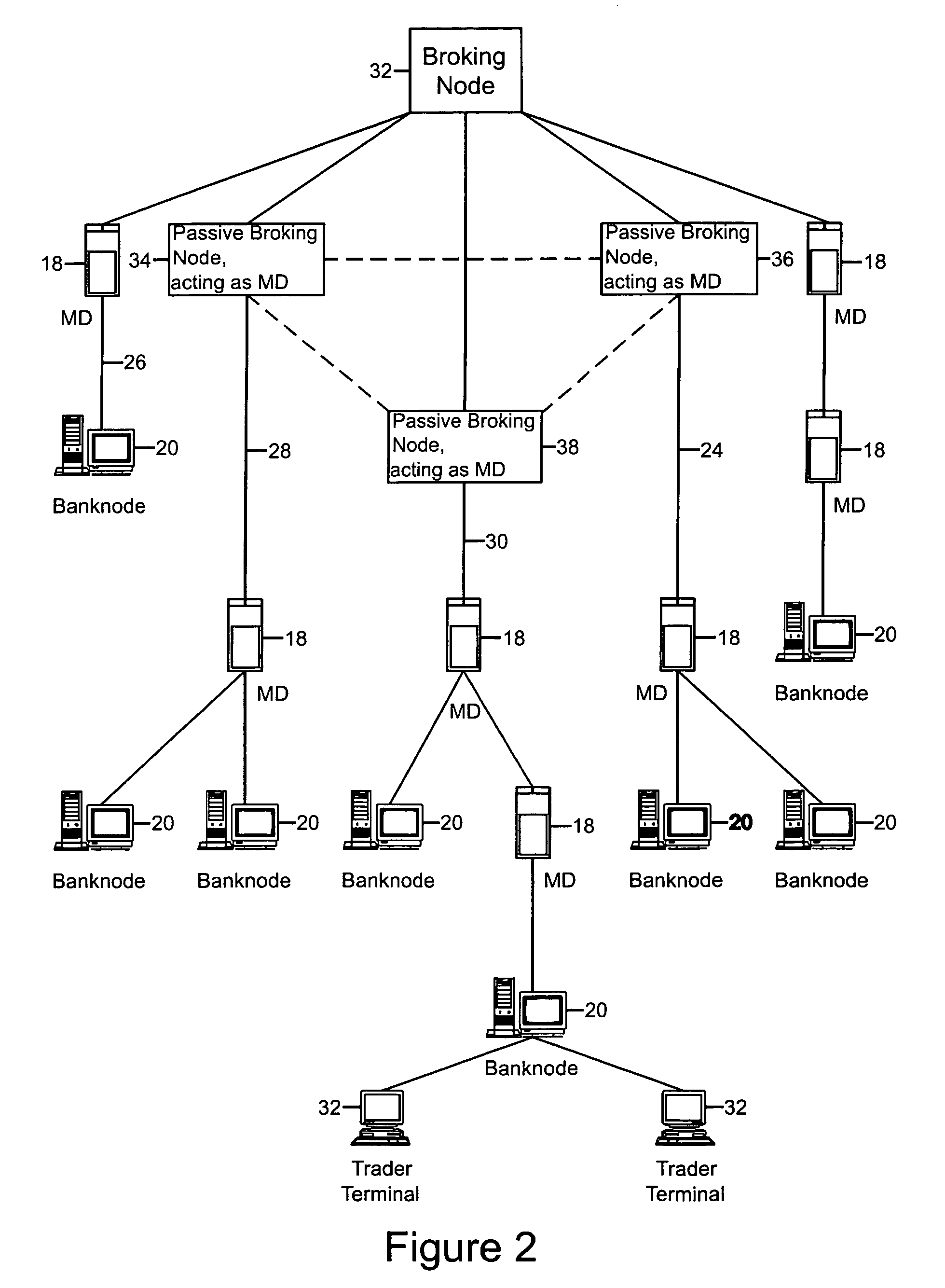

Anonymous trading system

An anonymous trading system has a clique of arbitrators which match orders from trader terminals and execute deals. One or more branches is attached to each arbitrator connecting trader terminals through a city node and one or more market distributors. At any one time only one arbitrator is active with the passive arbitrators active as market distributors. The active arbitrator is switched according to the geographical location of the greatest market activity.

Owner:CME GRP

System and method for creating and administering an investment instrument

Owner:AMERIPRISE FINANCIAL

Financial market replicator and simulator

A financial market replicator, simulator, and trainer / annotator (FMRS) intermixes and records data streams of real time financial market data from a variety of sources. The FMRS replays such recorded data to simulate the real time financial market(s) in a manner that represents substantially the entirety of information relating to the financial market(s) such that an observer would have difficulty differentiating between the simulator playback of the data and real time data. A user may employ the playback of the recorded market data stream as a research and training tool for developing and executing trading strategies. For example, a user may input simulated trades of securities to test a trading strategy. The simulator would apply those trades to the recorded data to generate simulated trades and simulated profit and loss results. A user may then determine if the trading strategy would have been successful. In addition, a user may alter the recording and playback parameters to provide various opportunities for studying market activity and / or altering the level of challenge of the simulation. A user may also freeze the simulator playback in order to explore the interactive and collective behaviors of the market's participants and the securities they trade.

Owner:ADVANCED INTPROP GROUP

System and method for creating and administering an investment instrument

The present invention provides a system and method for creating and administering an investment instrument. More specifically, the present invention provides a system and method for creating and administering an investment instrument that may be cleared through a depository company, that has relatively short terms and / or that enables investors to participate in financial market activity while protecting their principal investments. In accordance with one embodiment of the invention, an investment instrument preserves an investor's principal and offers a choice of several models for generating return. Return-generating models may allow an investor to participate fully in market movement, participate partially in market movement with a guaranteed minimum return, or receive a fixed return without participating in market movement.

Owner:AMERIPRISE FINANCIAL

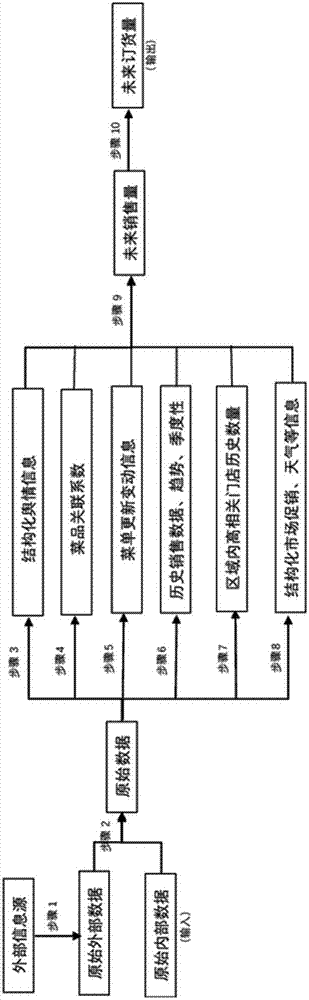

System and method for implementing sales forecasting in catering industry

InactiveCN107292672AAchieve forecastSpecial data processing applicationsMarketingPredictive methodsInformation mining

The invention discloses a system and a method for implementing sales forecasting in the catering industry. Acquisition and information mining are performed on external data such as online review platform data, geographic position information data, weather information, market information and the like and internal data such as pos data, store information, dish information, company market activity information and the like by adopting a crawler technology, an image recognition technology, a text analysis technology and a deep learning algorithm, a fused forecasting model is established, week-by-week dish sales data within future three months is given, and a future order plan is given in combination with dish BOM (Bill of Material), store inventory, total warehouse inventory, safety inventory MRP (Material Requirements Planning) and the like. Compared with other exiting forecasting method, the MAPE (Mean Absolute Percentage Error) can be improved from 30-40% to 10-15%.

Owner:上海数道信息科技有限公司

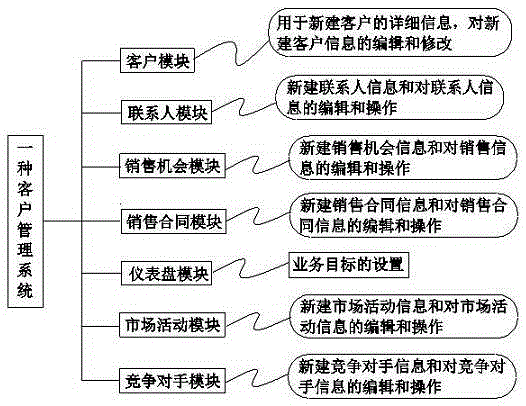

Client management system

InactiveCN105243491AImprove work efficiencyImprove sales management efficiencyBuying/selling/leasing transactionsResourcesThe InternetClient data

The present invention relates to the field of internet application, in particular to a client management system. The system comprises a client module, a contact module, a sales opportunity module, a sales contract module, an instrument panel module, a market activity module and a competitor module. The client management system can help sales staff to improve the work efficiency, the situation of each client can be recorded and displayed in details, and the error rate is lowered; and the client management system helps enterprises to improve sales management efficiency, the clients are prevented from being taken away due to the loss of the sales staff, and client data is stored on a system server.

Owner:HENAN ZHIYE TECH DEV +1

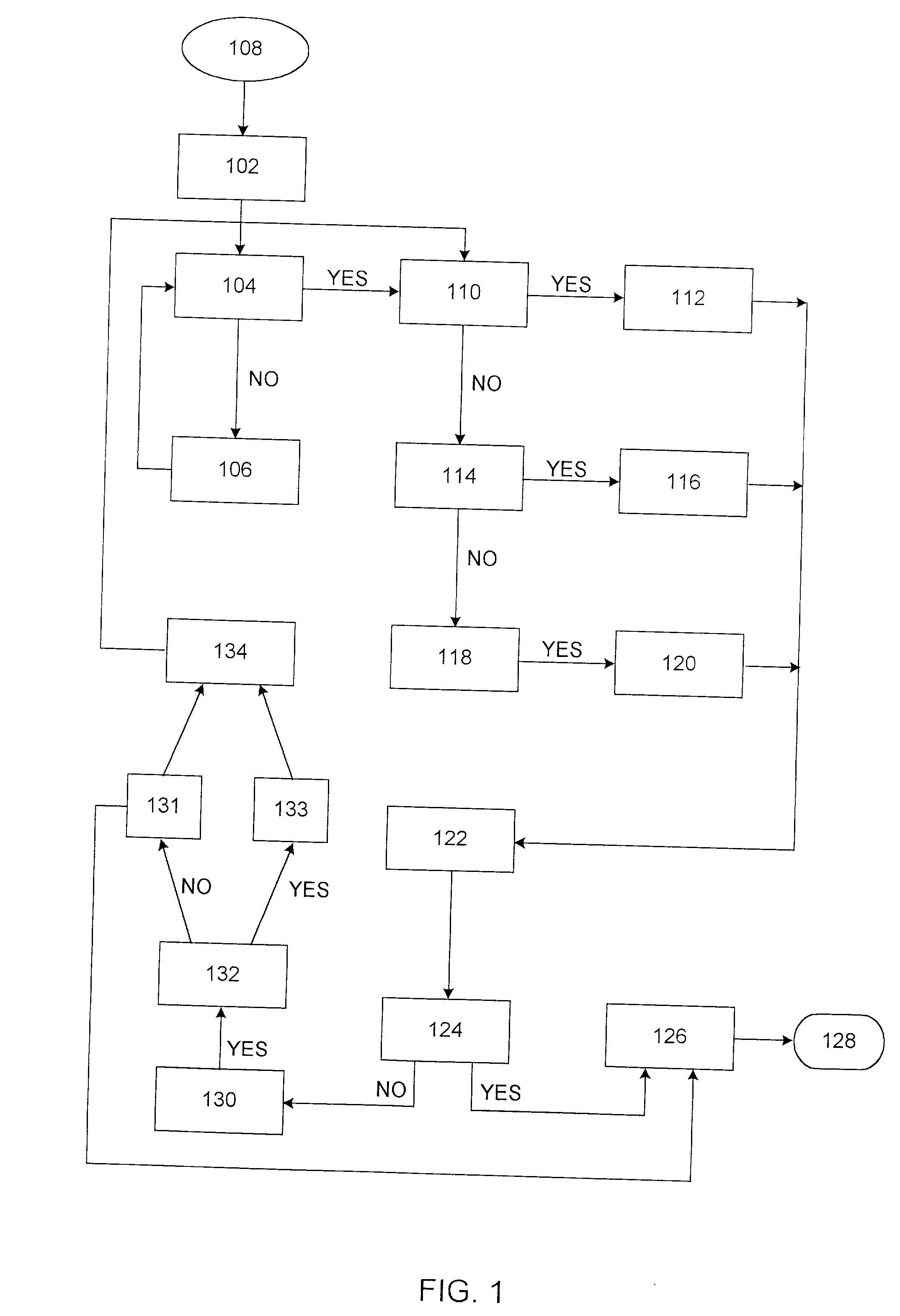

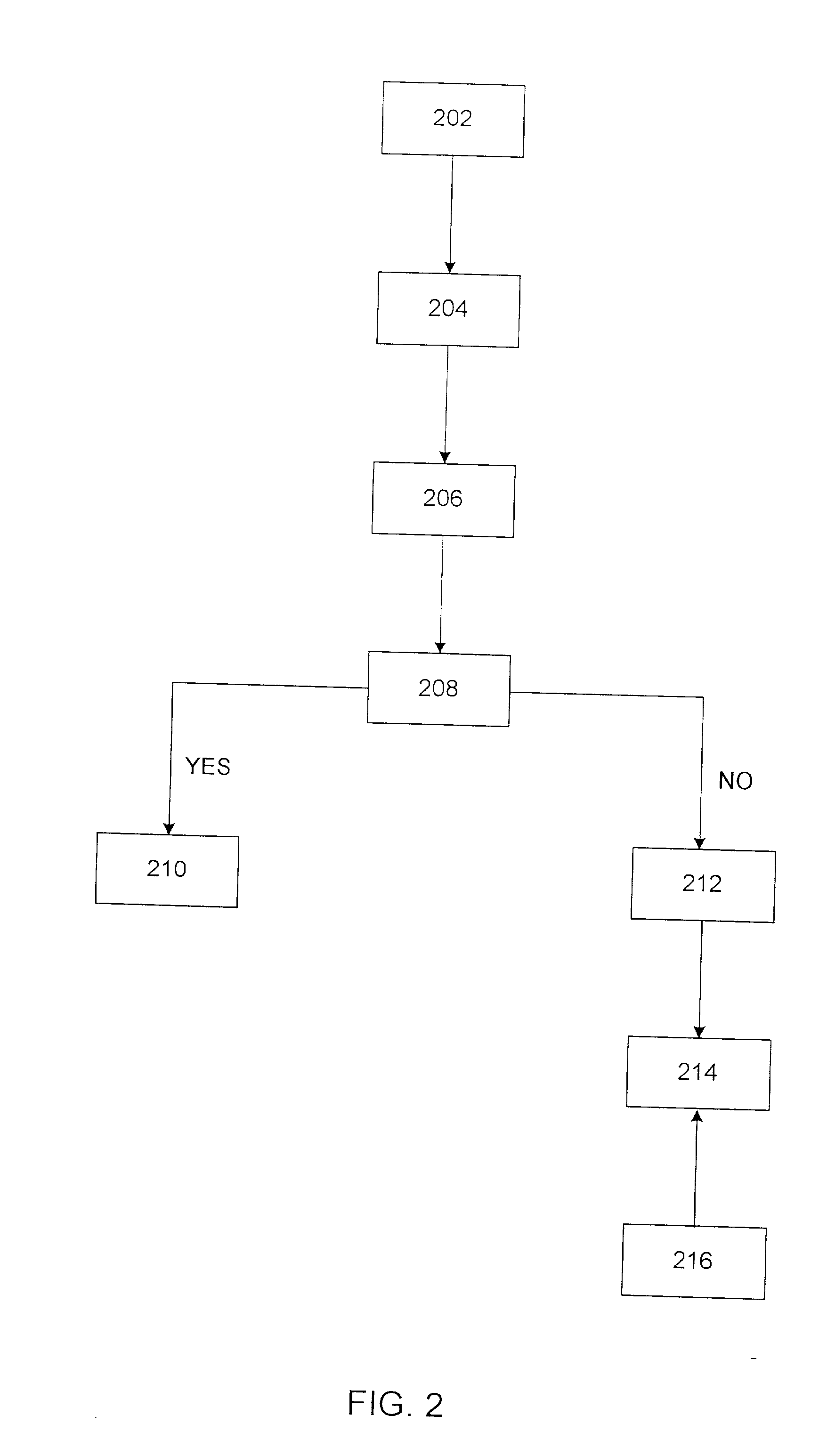

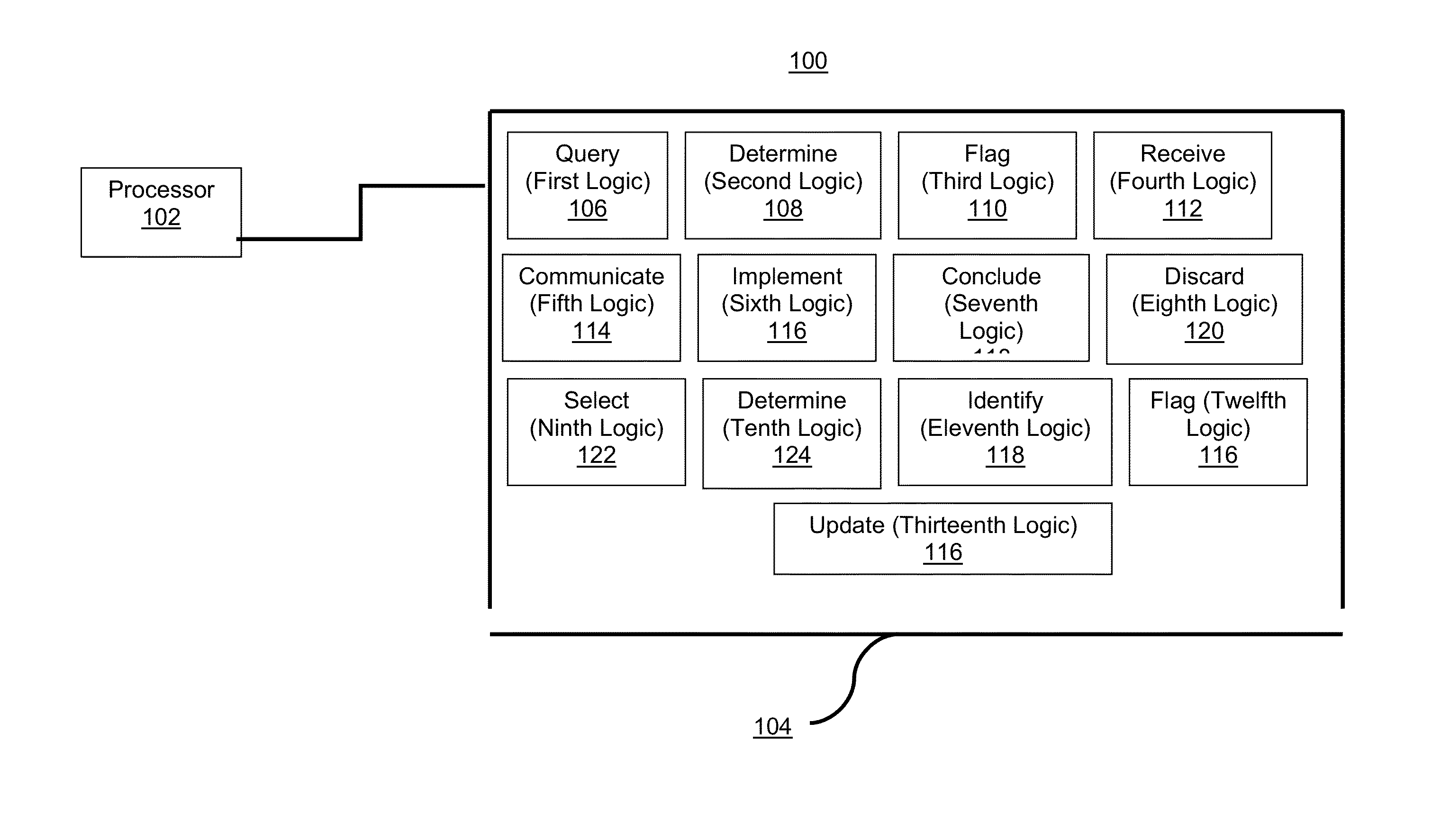

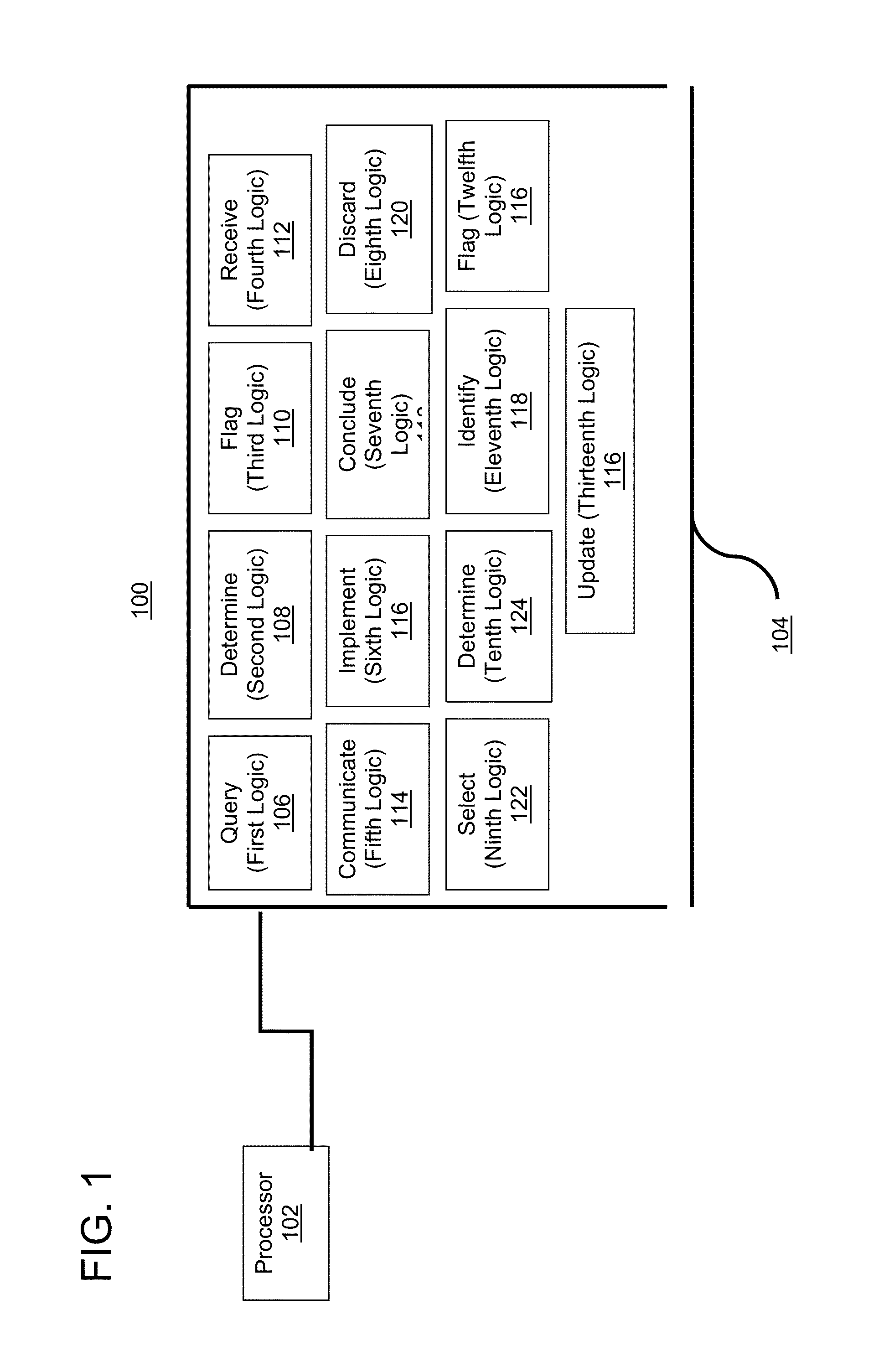

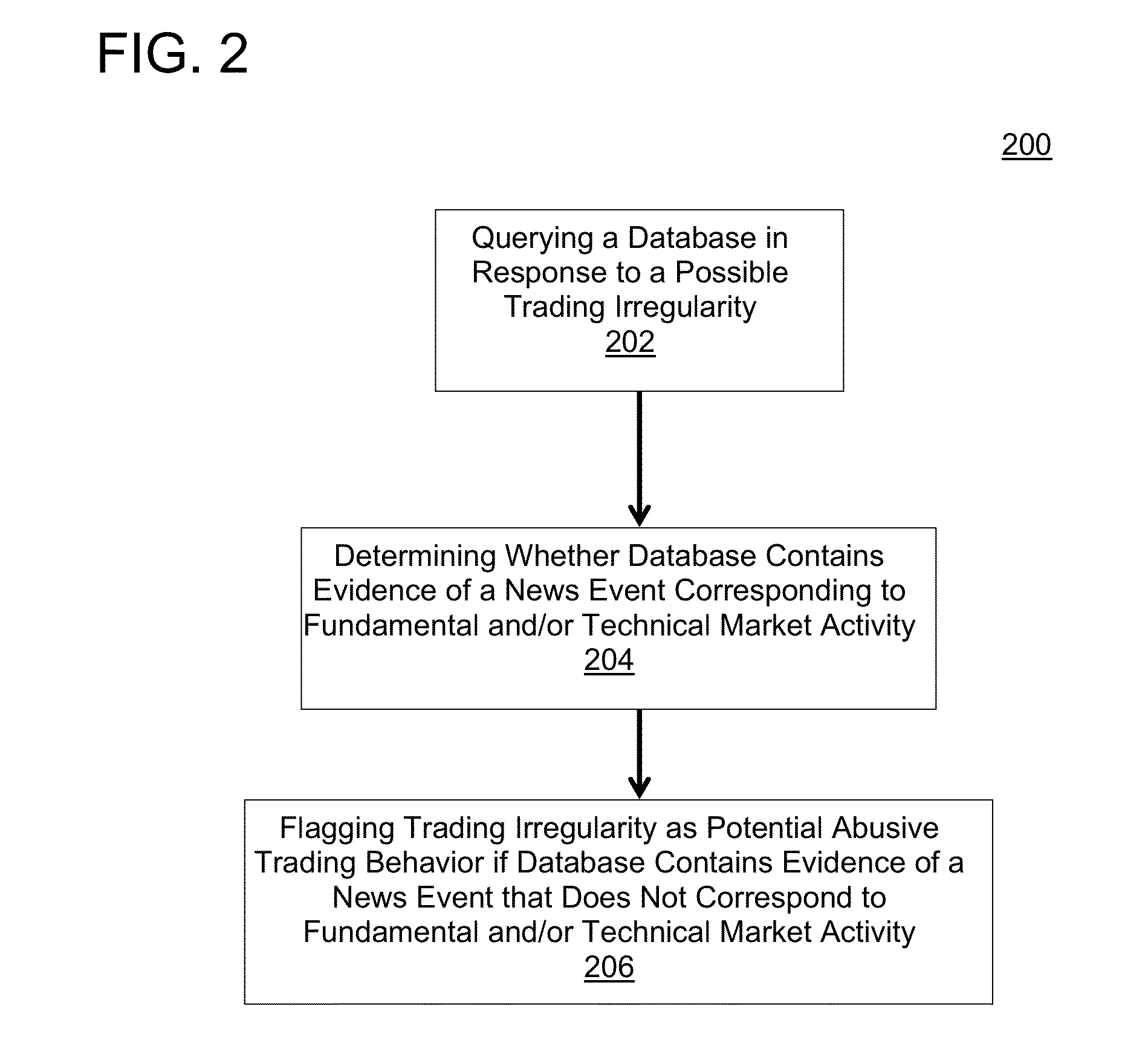

Detection of Potential Abusive Trading Behavior in Electronic Markets

Methods for detecting potential abusive trading behavior in an electronic market include: (a) querying a database in response to an alert signifying a possible trading irregularity, wherein the database is configured to store data mined from one or a plurality of electronic social media platforms; (b) determining whether the database contains evidence of a news event that explains the trading irregularity and, if so, whether the news event corresponds to fundamental and / or technical market activity; and (c) flagging the trading irregularity as potential abusive trading behavior if the database contains evidence of the news event but it is determined that the news event does not correspond to fundamental and / or technical market activity. Systems for detecting potential abusive trading behavior in an electronic market are described.

Owner:CHICAGO MERCANTILE EXCHANGE

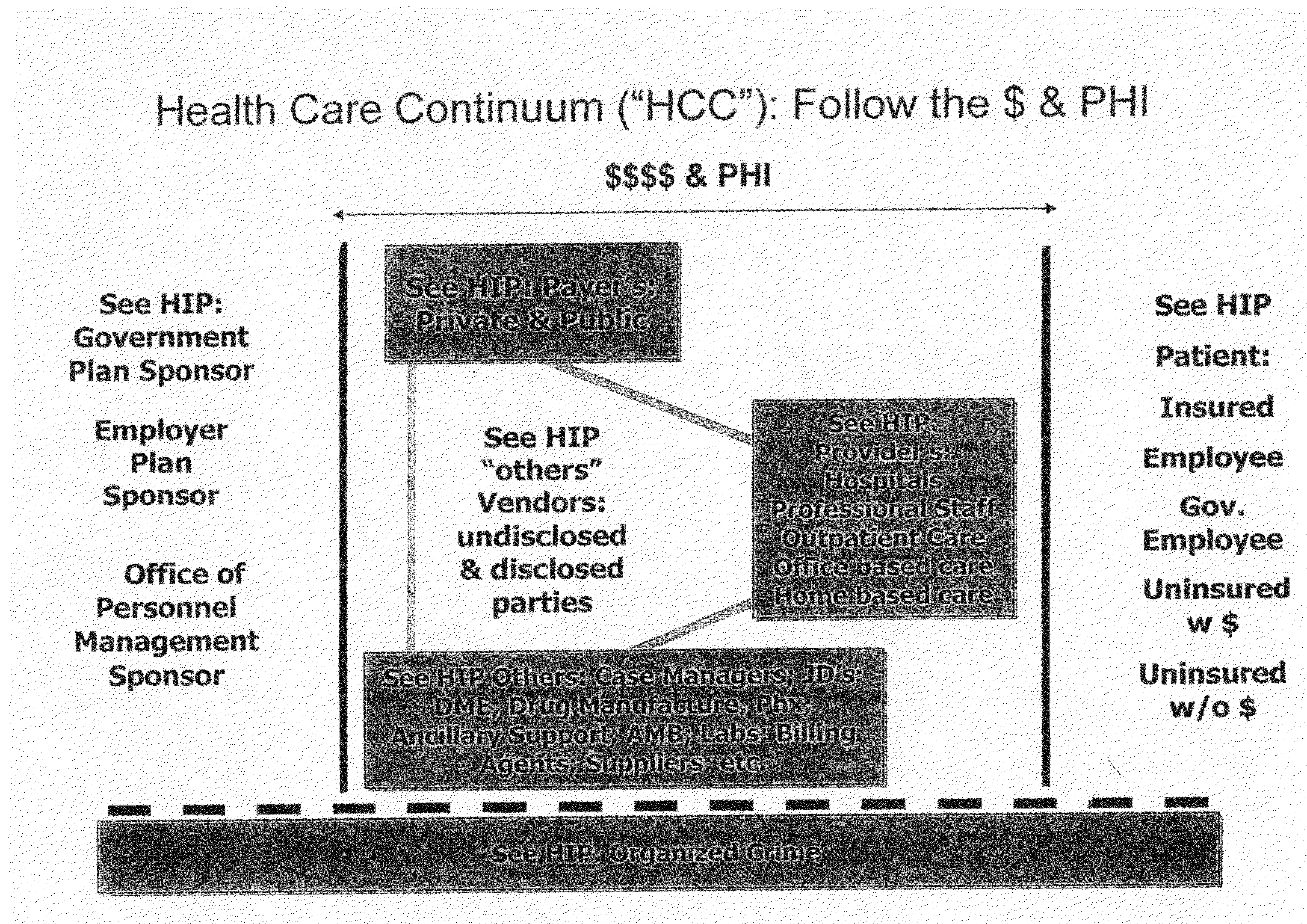

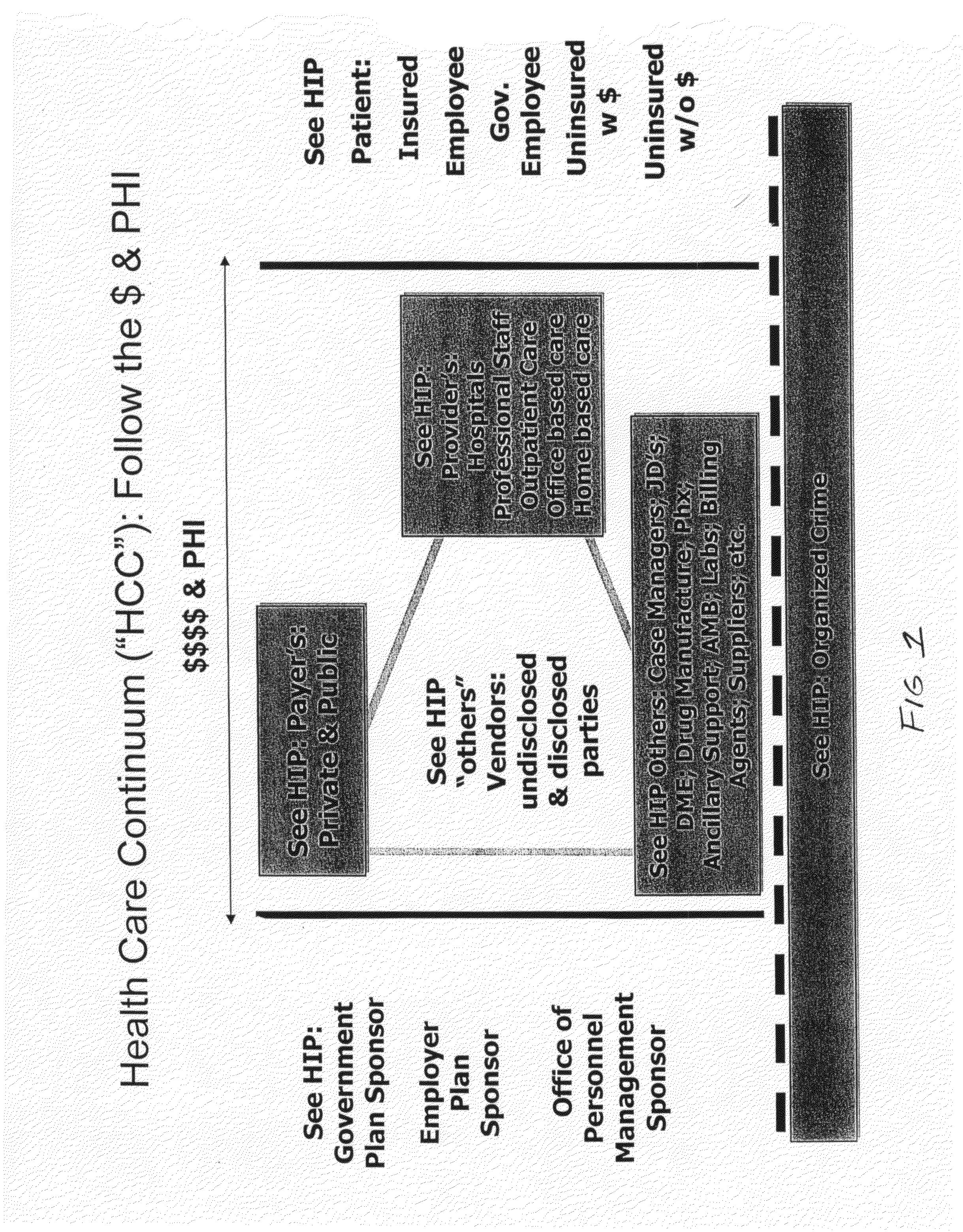

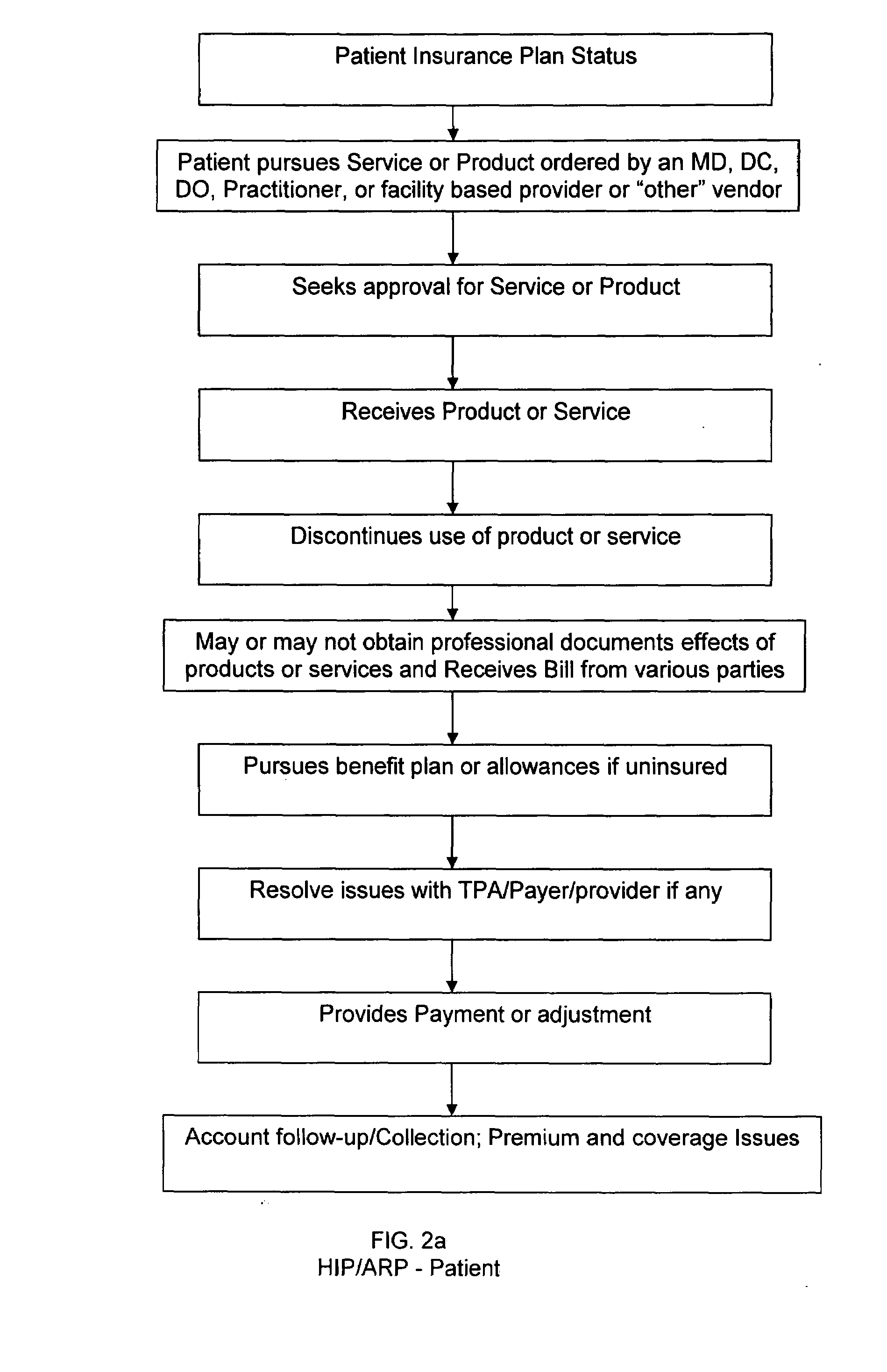

Anomaly tracking system and method for detecting fraud and errors in the healthcare field

An electronic data analysis system and method of anomaly tracking decision trees for identifying anomalies to detect errors or fraud in multiple healthcare operational functions. The unique aspects of such electronic tools include the contemporaneous data mining and data mapping aspects of Health Information Pipelines, Private Health Information, Operational Flow Activities, and Accounts Receivable Pipelines, Product Market Activity, Service Market Activity, Consumer Market Activity in large quantities. The contemporaneous data analytics provide an effective and efficient tool for untapped for market problems such as waste, fraud, abuse, and general aberrations that impact the cost and delivery of healthcare services and products. The tool is interactive and self learning.

Owner:BUSCH REBECCA S

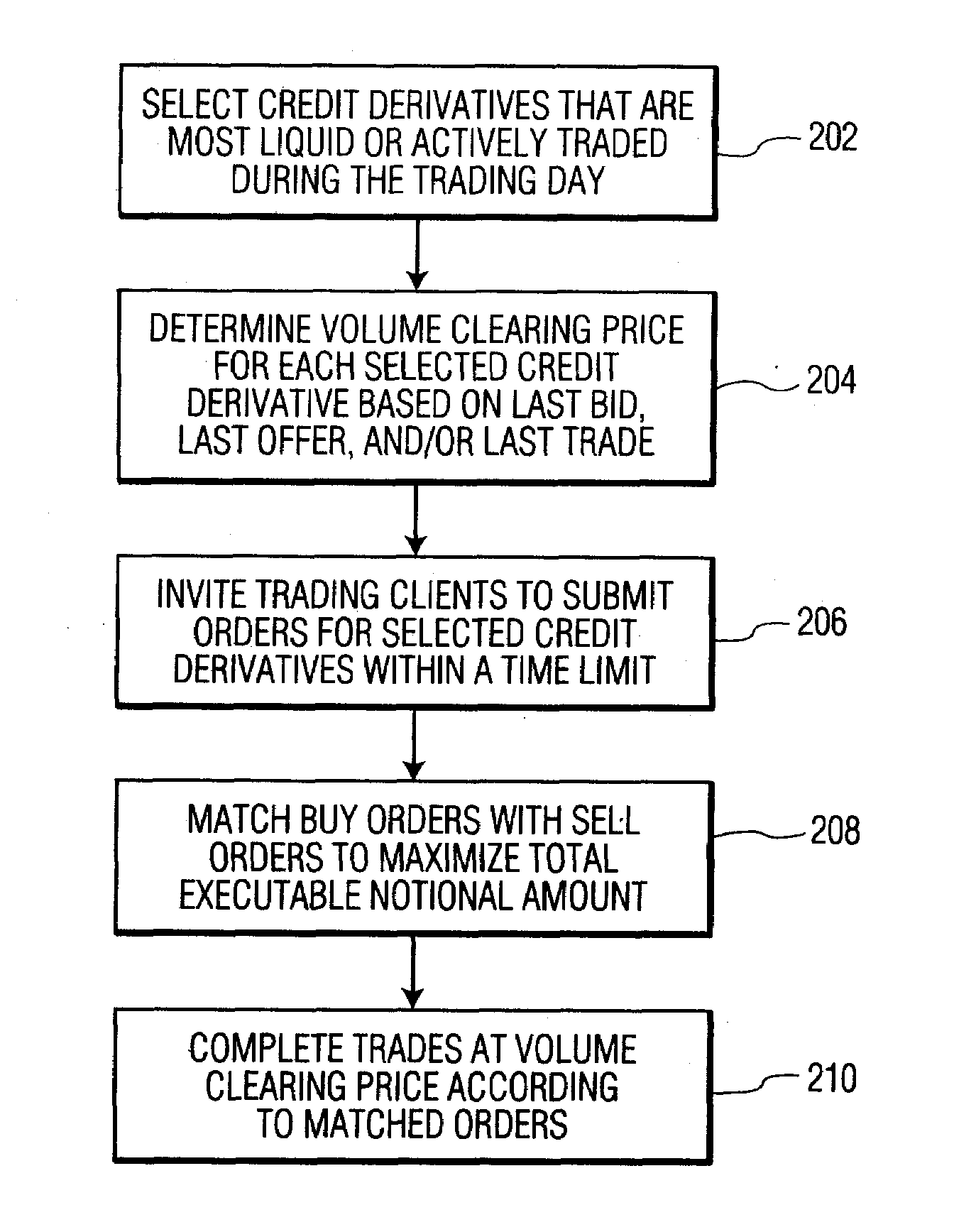

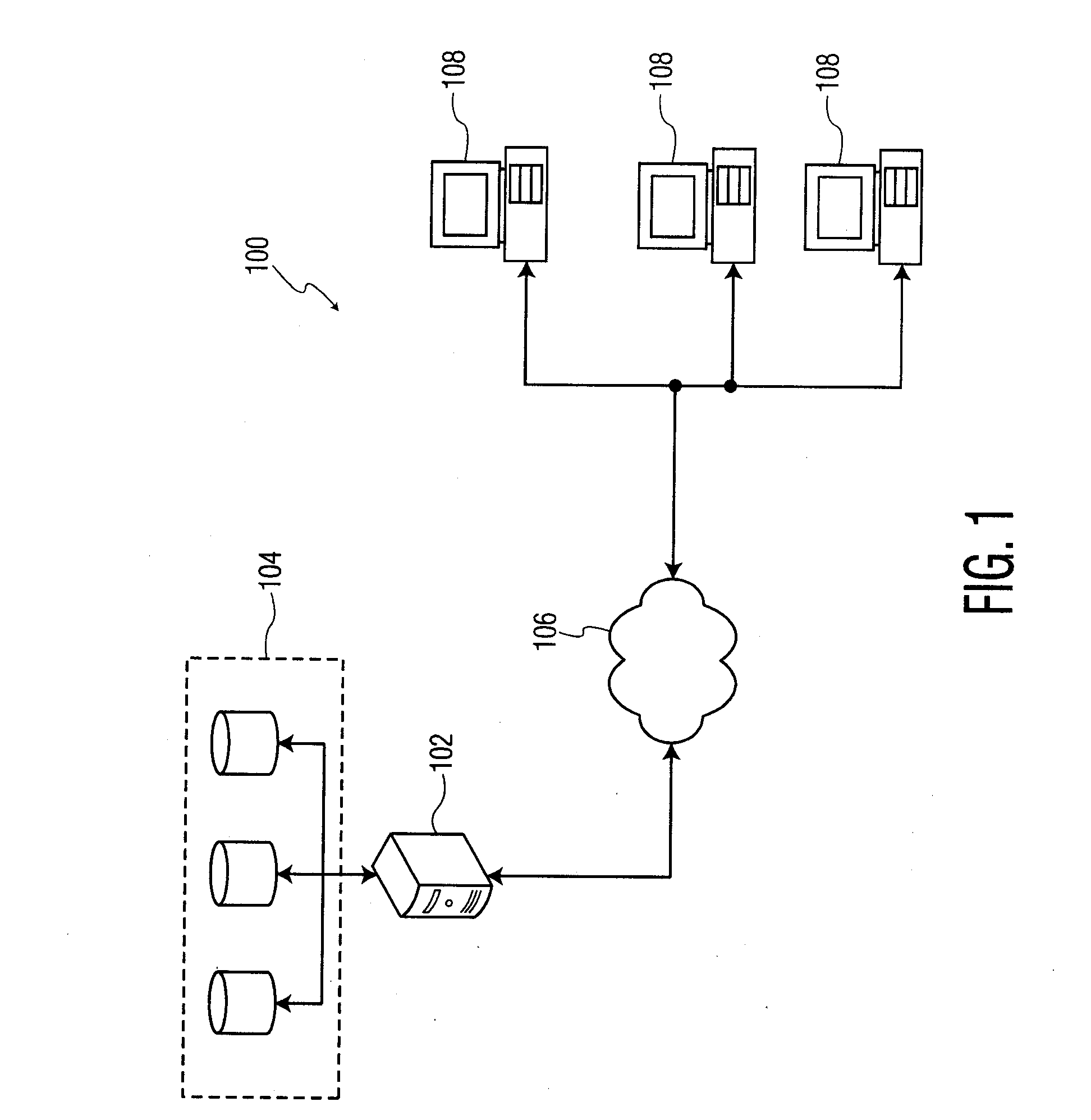

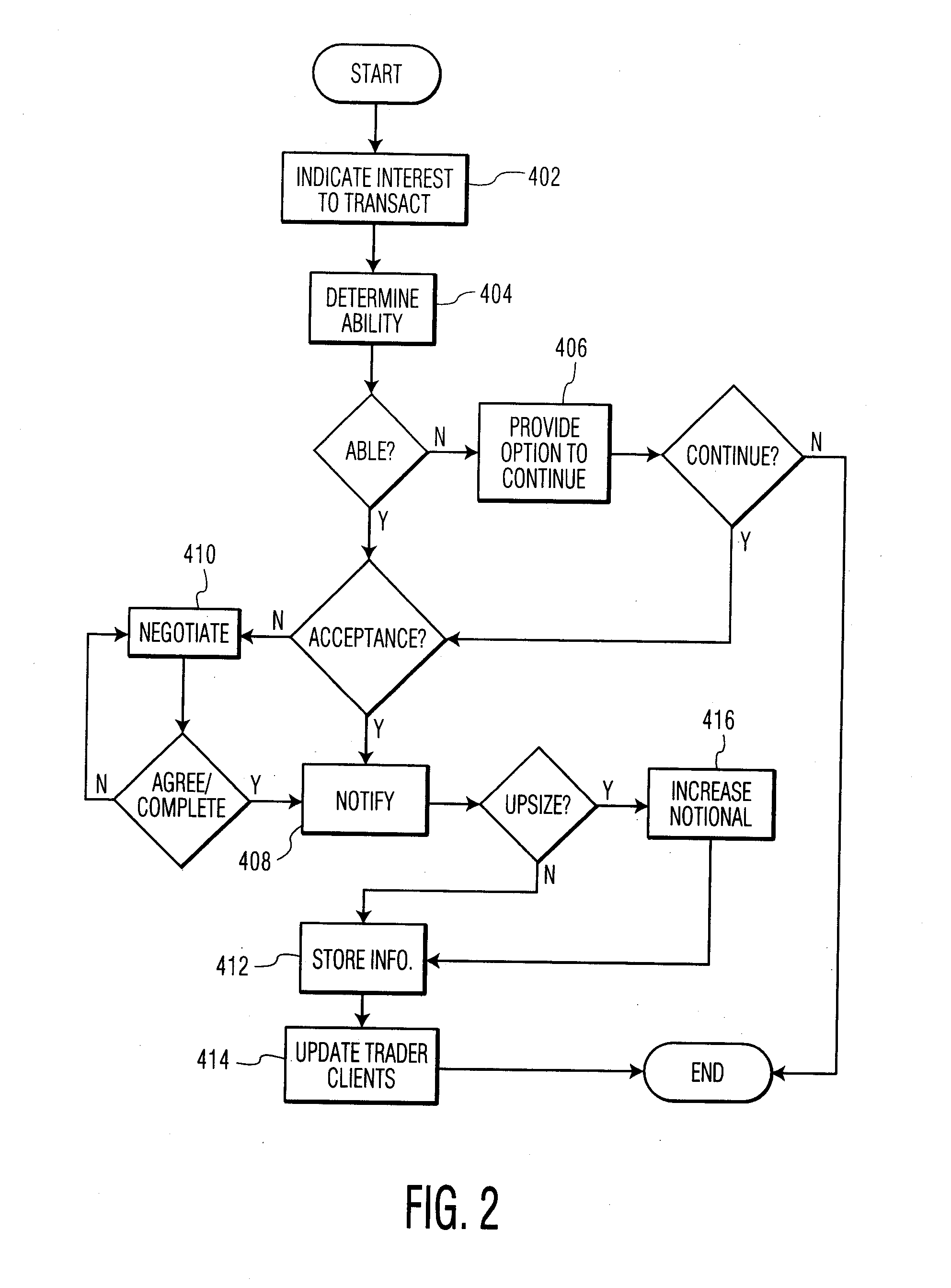

Systems and Methods for Limit Order Volume Clearing in Online Trading of Credit Derivatives

Systems and methods for limit order volume clearing in online trading of credit derivatives are disclosed. In one embodiment, a method for limit order volume clearing may comprise: selecting a set of credit derivatives based on dealer interest and market activities; inviting trading clients to submit, within a time limit, buy orders and sell orders for the selected credit derivatives; determining an auction price for each of the selected credit derivatives, such that a total notional amount of trades that can be executed at the auction price is the largest possible and a total notional amount of unfilled orders is the smallest possible: executing a first subset of the buy orders and the sell orders that can be completed at the determined auction price; and launching a volume clearing session, with a volume clearing price level set to the determined auction price, for a second subset of the buy orders and the sell orders that have not been filled.

Owner:CREDITEX GROUP

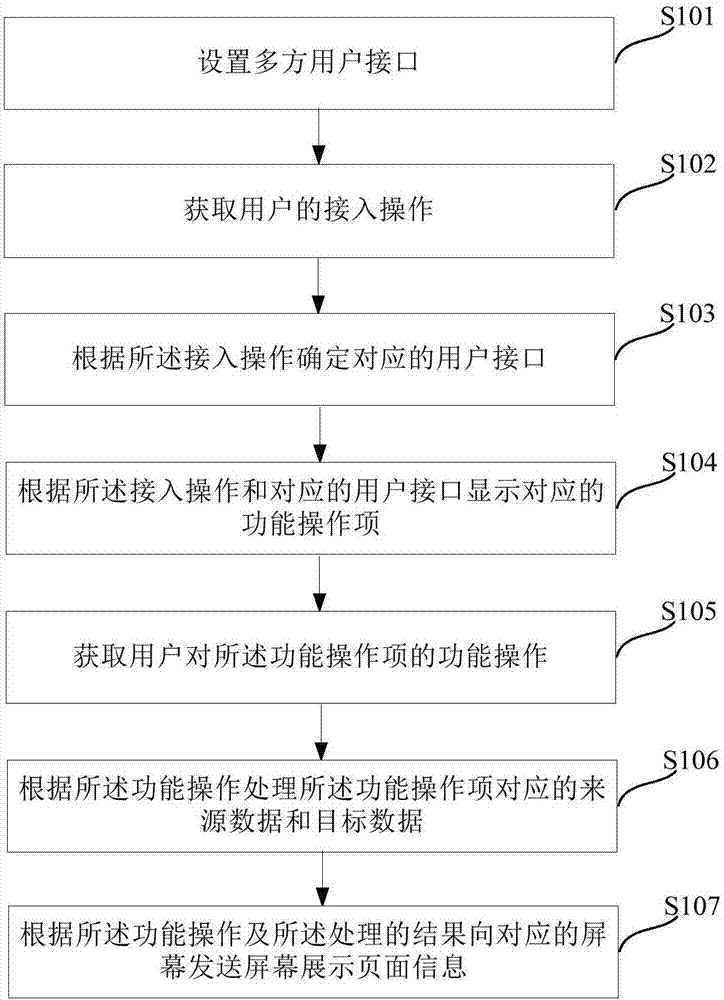

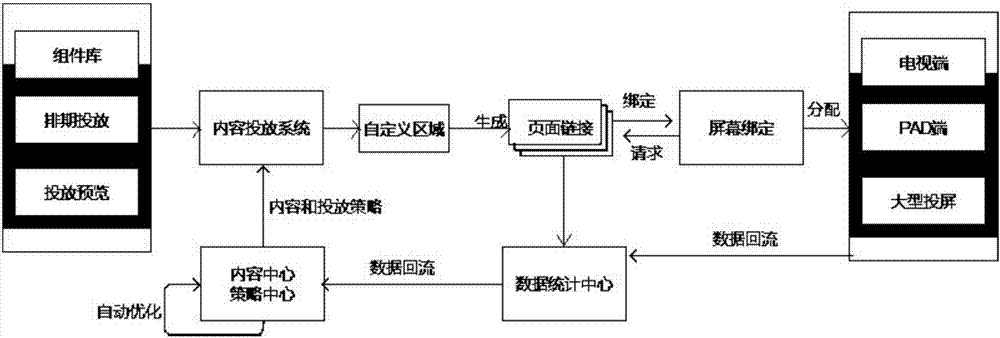

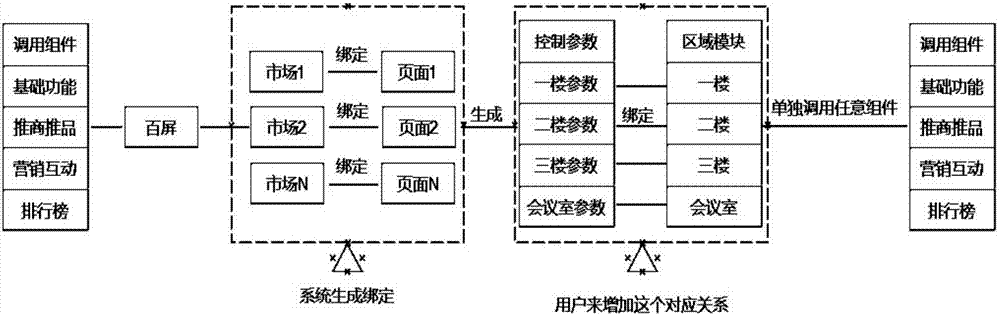

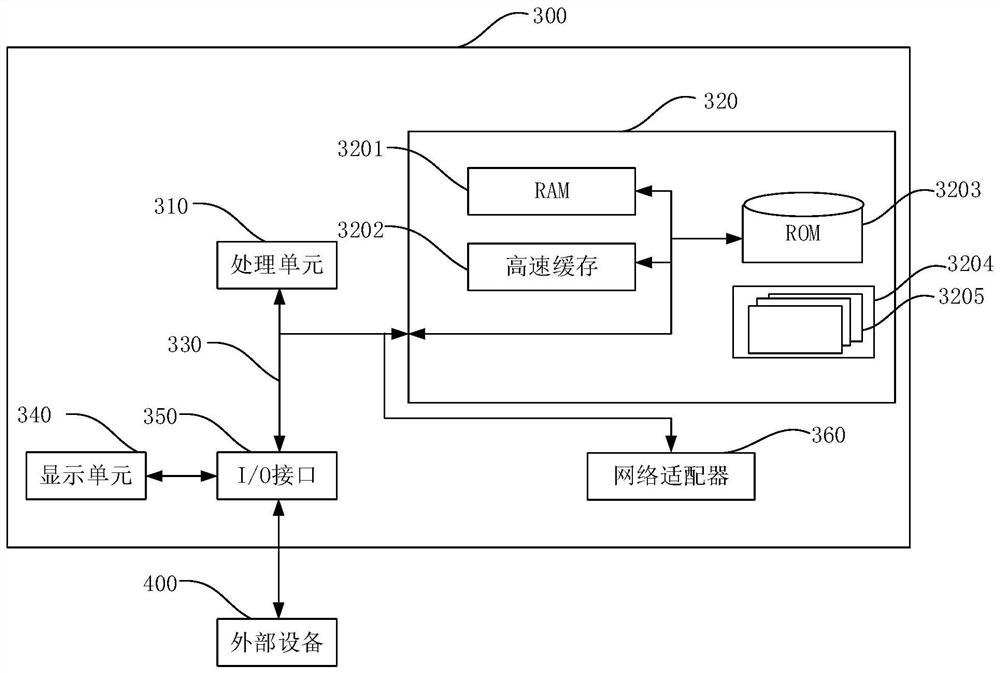

Method and system for multi-screen control

ActiveCN107015775AEfficient planningEffective controlMarketingDigital output to display deviceStatistical analysisOn-screen display

Embodiments of the invention disclose a method and a system for multi-screen control. The method comprises: arranging a multi-party user interface; obtaining access operation of a user; according to the access operation, determining a corresponding user interface; according to the access operation and the corresponding user interface, displaying a corresponding function operation item; obtaining function operation of the user on the function operation item; according to the function operation, processing source data and target data corresponding to the function operation item; and according to the function operation and a processing result, sending a screen showing page message to the corresponding screen. The user can determine contents, time, and methods of page display, and on which screens the page is displayed, to complete control on screen display. Through showing screen advertisements, marketing resources in market are enriched, advertisement cost is reduced, and marketing effect is improved, and multi-party data statistic analysis is realized, so as to efficiently plan market activities.

Owner:ALIBABA GRP HLDG LTD

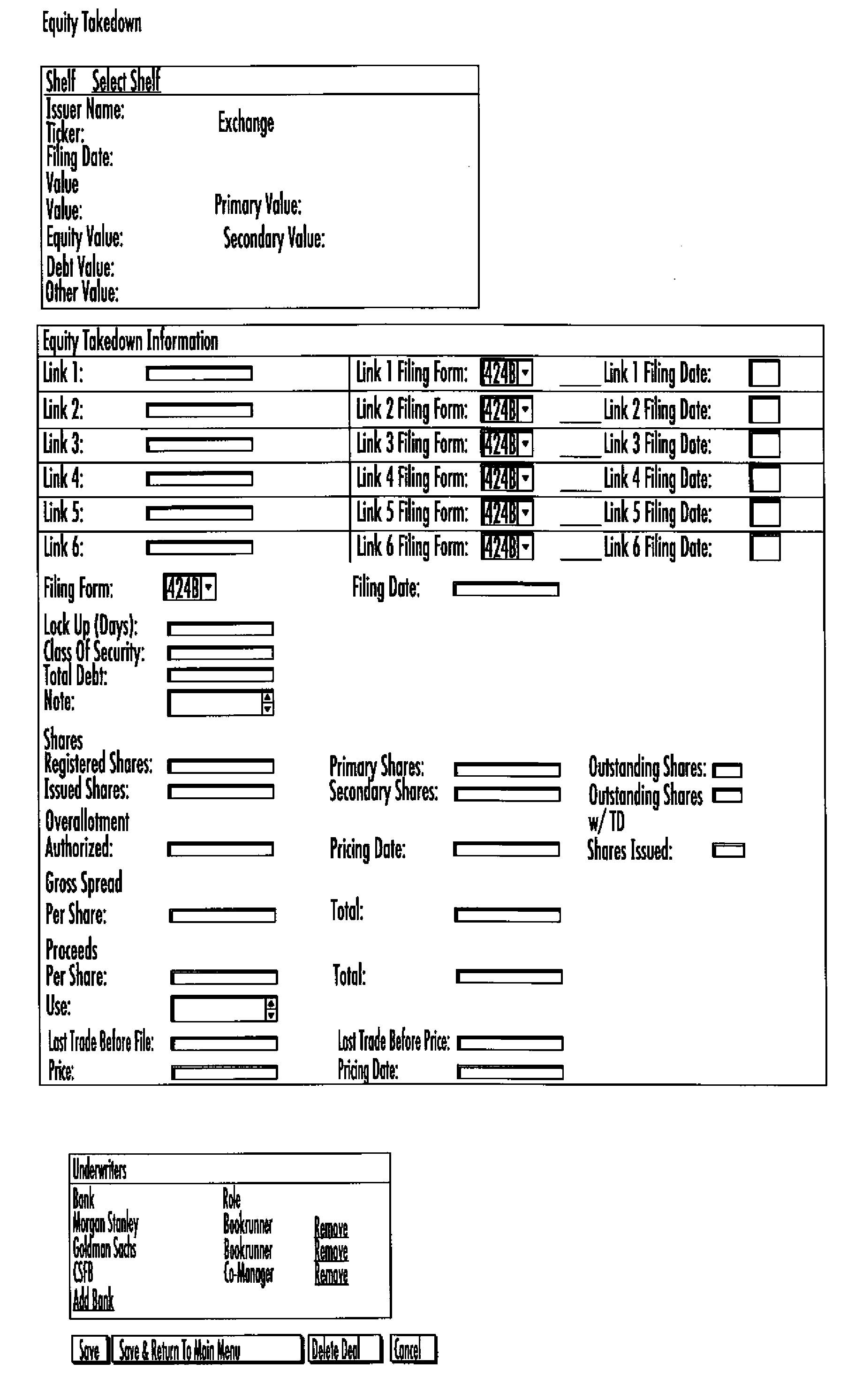

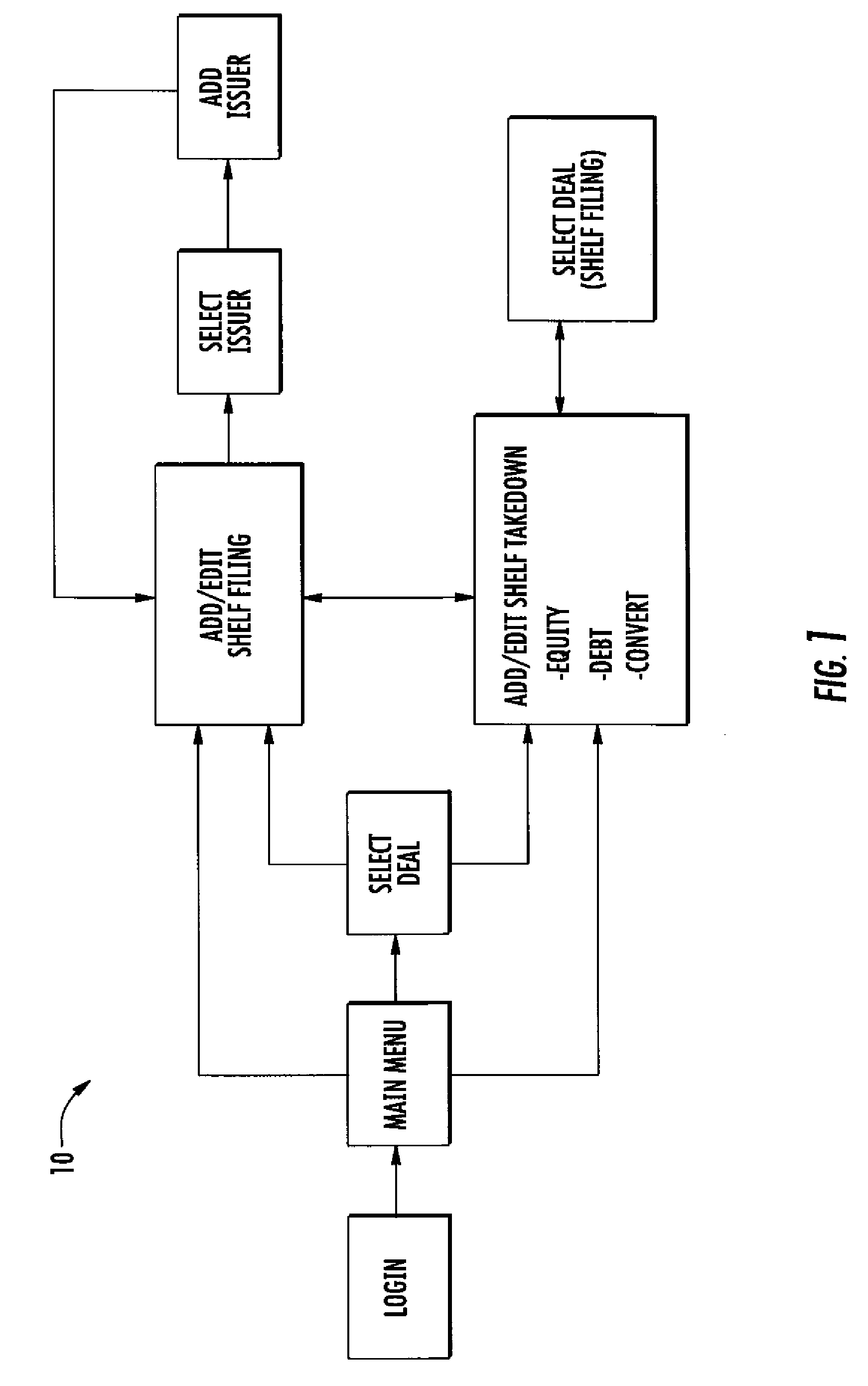

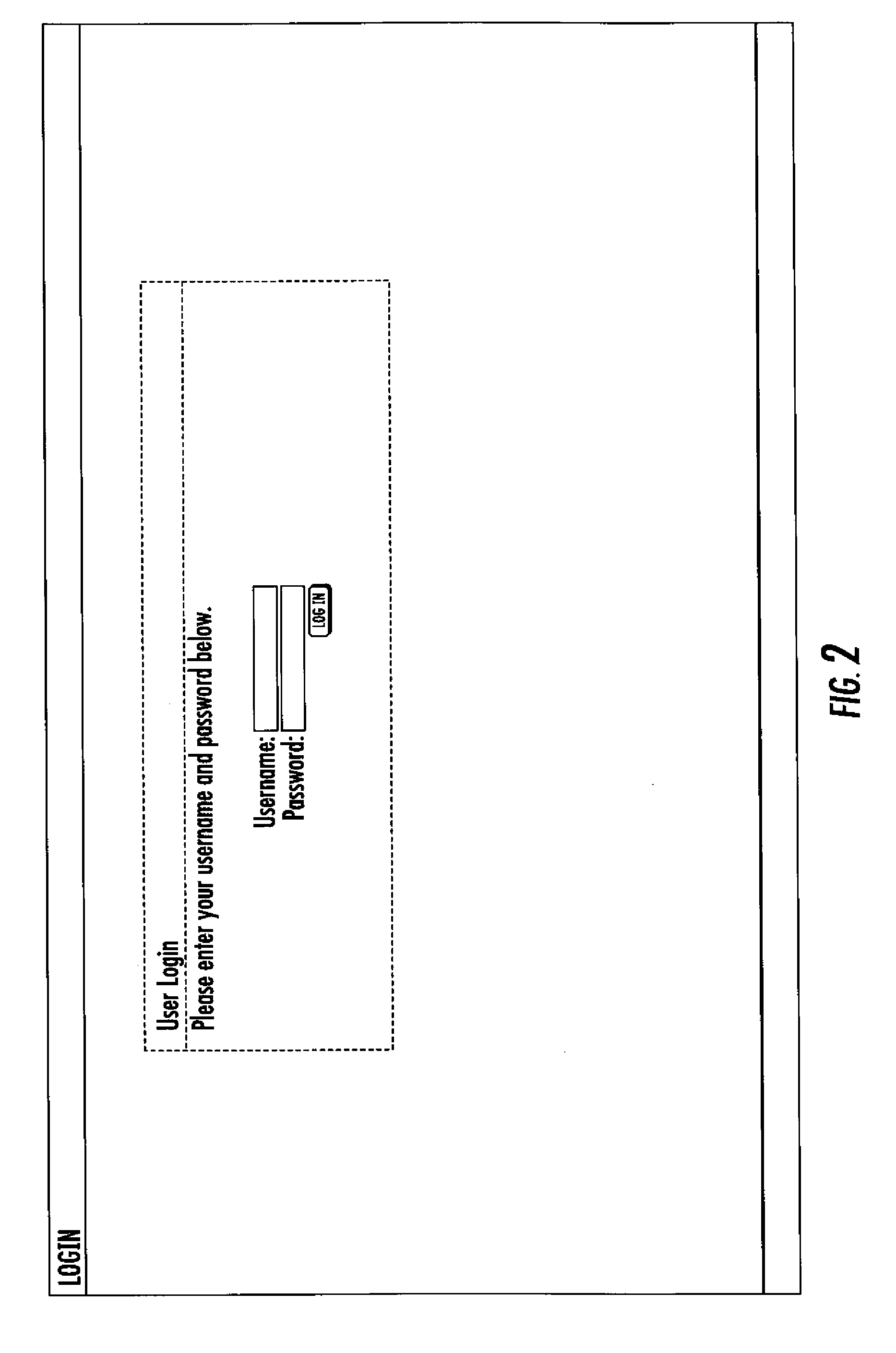

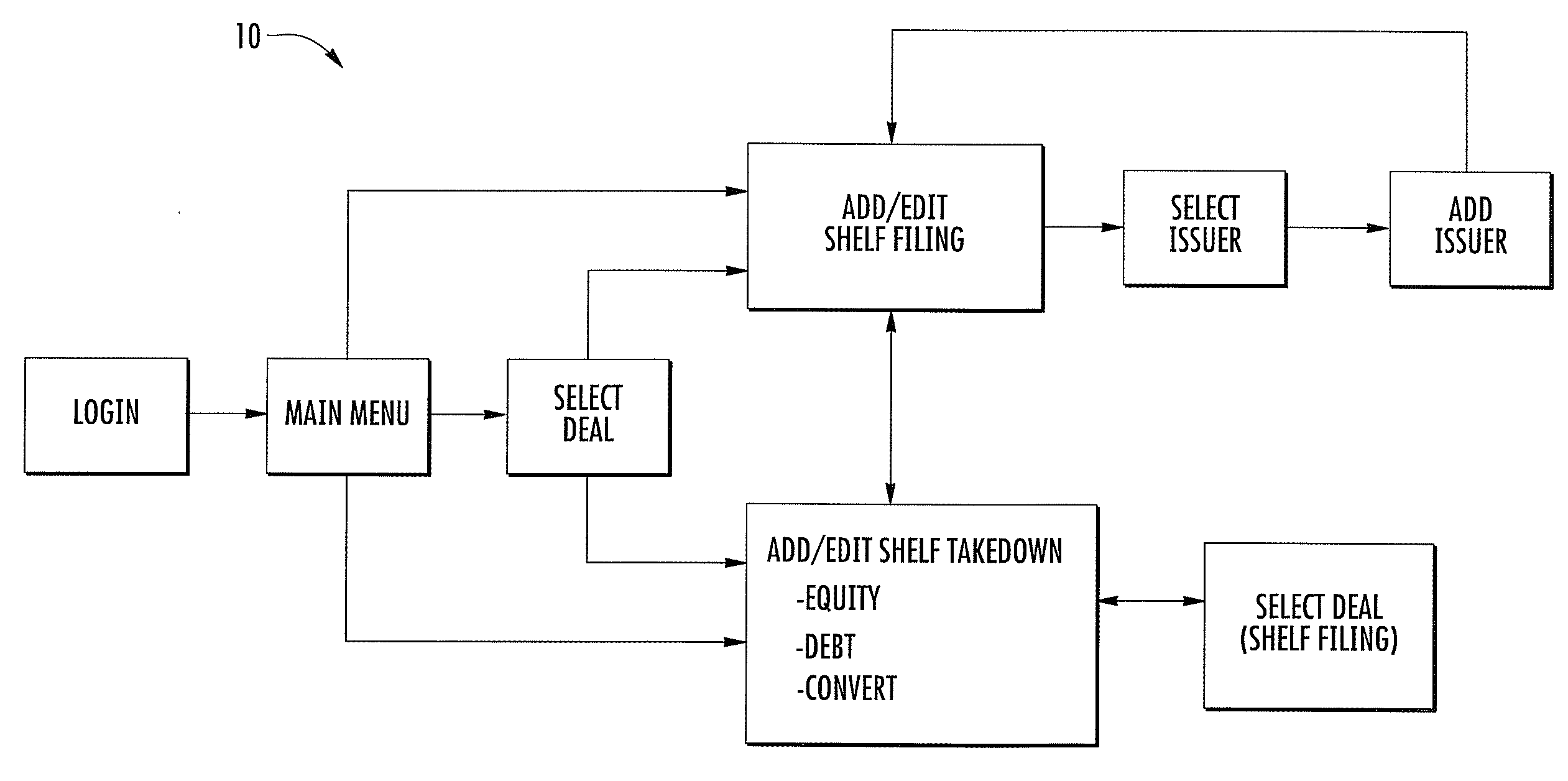

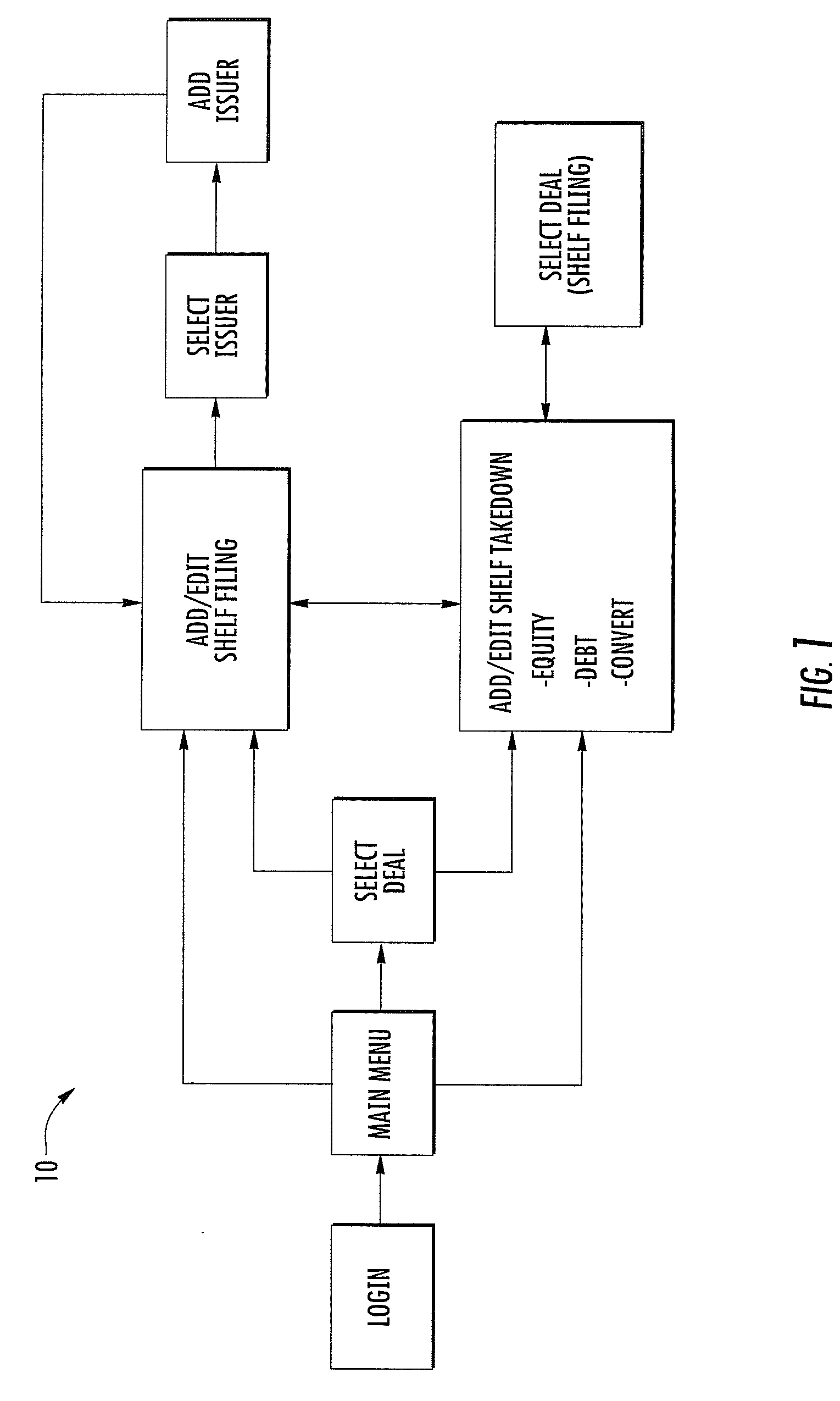

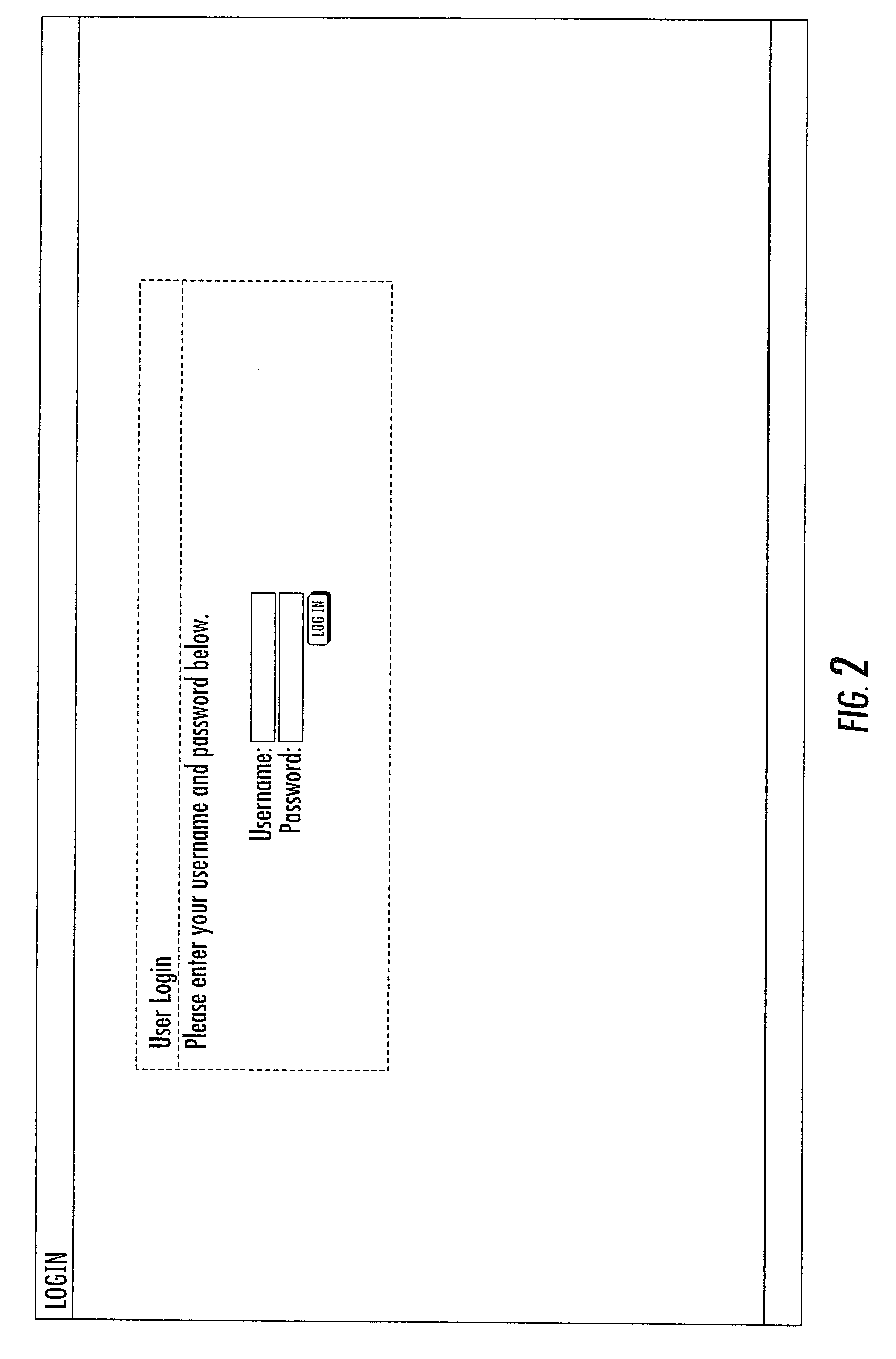

Financial data entry system

InactiveUS20070156658A1Track performanceFinanceSpecial data processing applicationsData storeData entry

A method of tracking and aggregating all Securities and Exchange Commission (SEC) “shelf” registration and all capital market activity related to those shelf registrations. The method includes the steps of accessing a first database containing data associated with investment registrations, wherein the data is organized as a series of individual filings. The method further includes the steps of retrieving data from the first database associated with selected ones of the filings, organizing the data into tables based on at least one aggregate aspect of the data common to multiple filings, and storing the retrieved data in at least one table.

Owner:RILEY CHARLES A

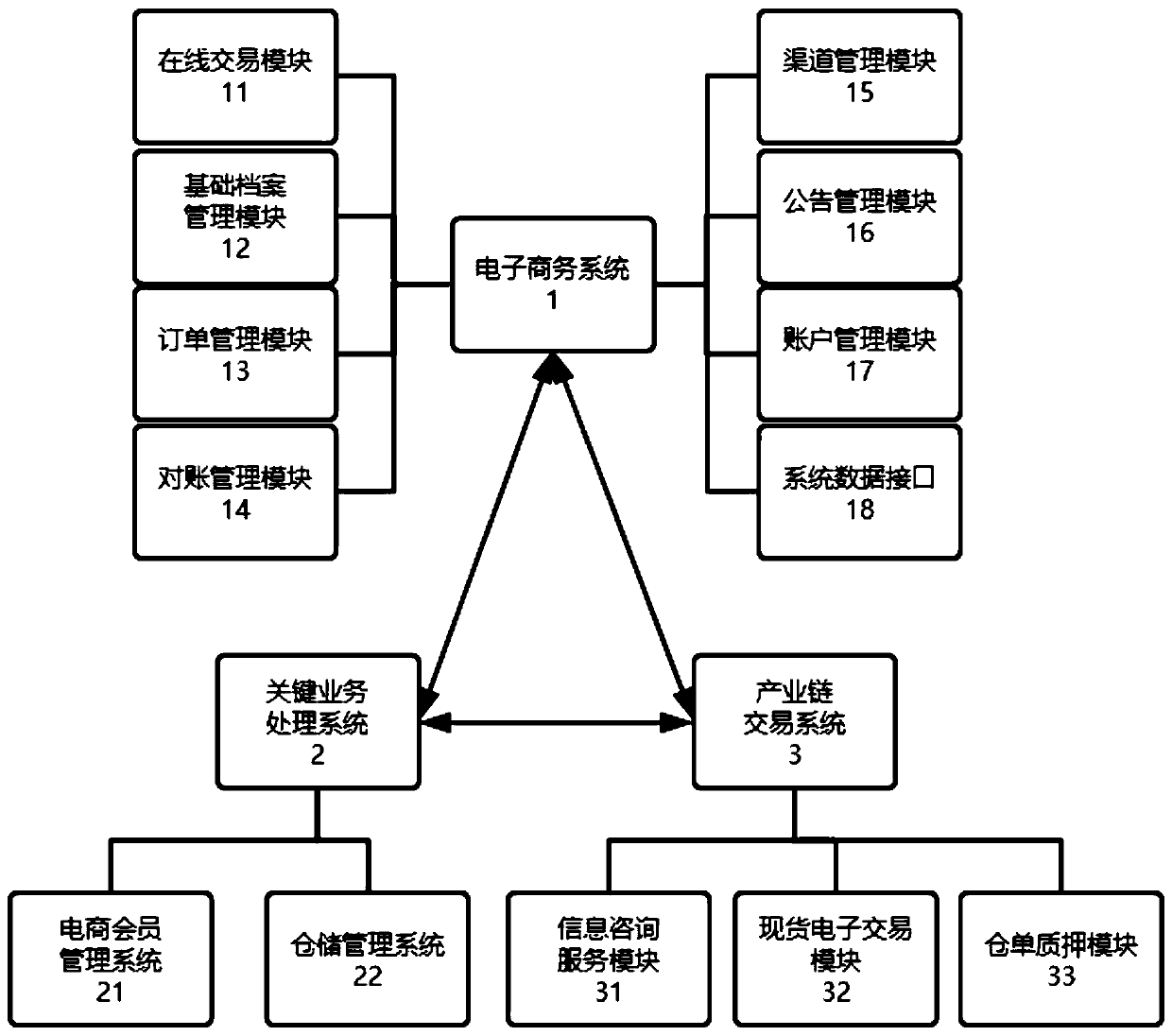

A multi-terminal mobile internet e-commerce system

PendingCN109934670ARealize flat managementReduce communication costsFinanceBuying/selling/leasing transactionsLogistics managementE-commerce

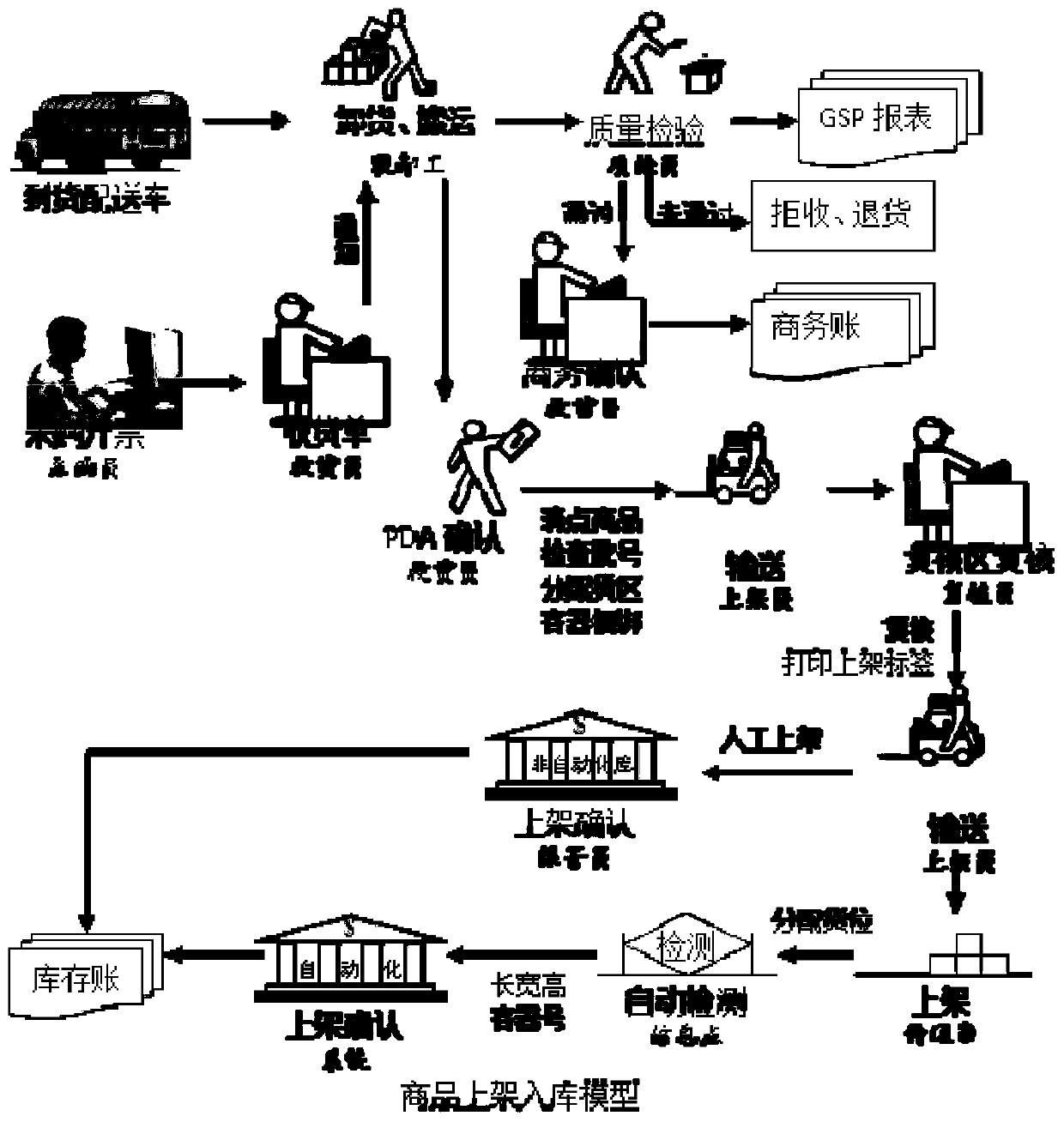

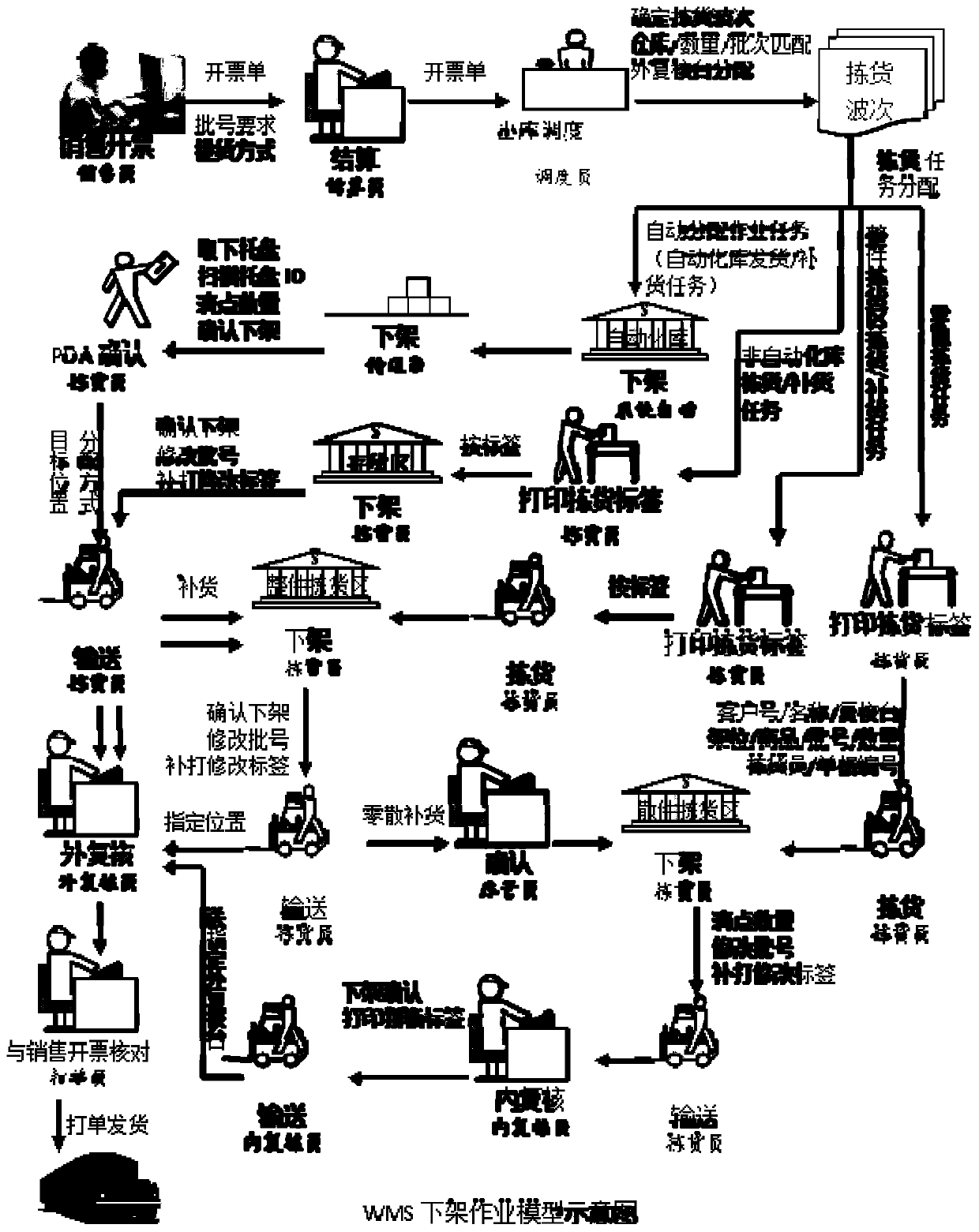

A multi-terminal mobile internet e-commerce system comprises an e-commerce system, a key business processing system and an industrial chain transaction system, the key business processing system comprises an e-commerce member management system and a warehouse management system, and the e-commerce system is used for online transaction, order collaboration, channel management and after-sales service; the e-commerce member management system is used for managing member information, analyzing member consumption conditions and managing market activity invitation; the warehouse management system is used for managing a commodity receiving and loading process, picking, repackaging, a delivery and transportation process and inventory management; the industrial chain management system realizes the management of information on commodities, companies, orders, transactions, settlements, buyers and sellers and is also used for credit guarantees, logistics and distribution, financial derivative services, operation and maintenance services, and system docking services, and the system can integrate financial, sales, inventory and purchase business data and related documents, assist business lines inbusiness cooperation and achieve effective management and control and efficient collaboration of business in enterprises.

Owner:海南福源灏实业股份有限公司

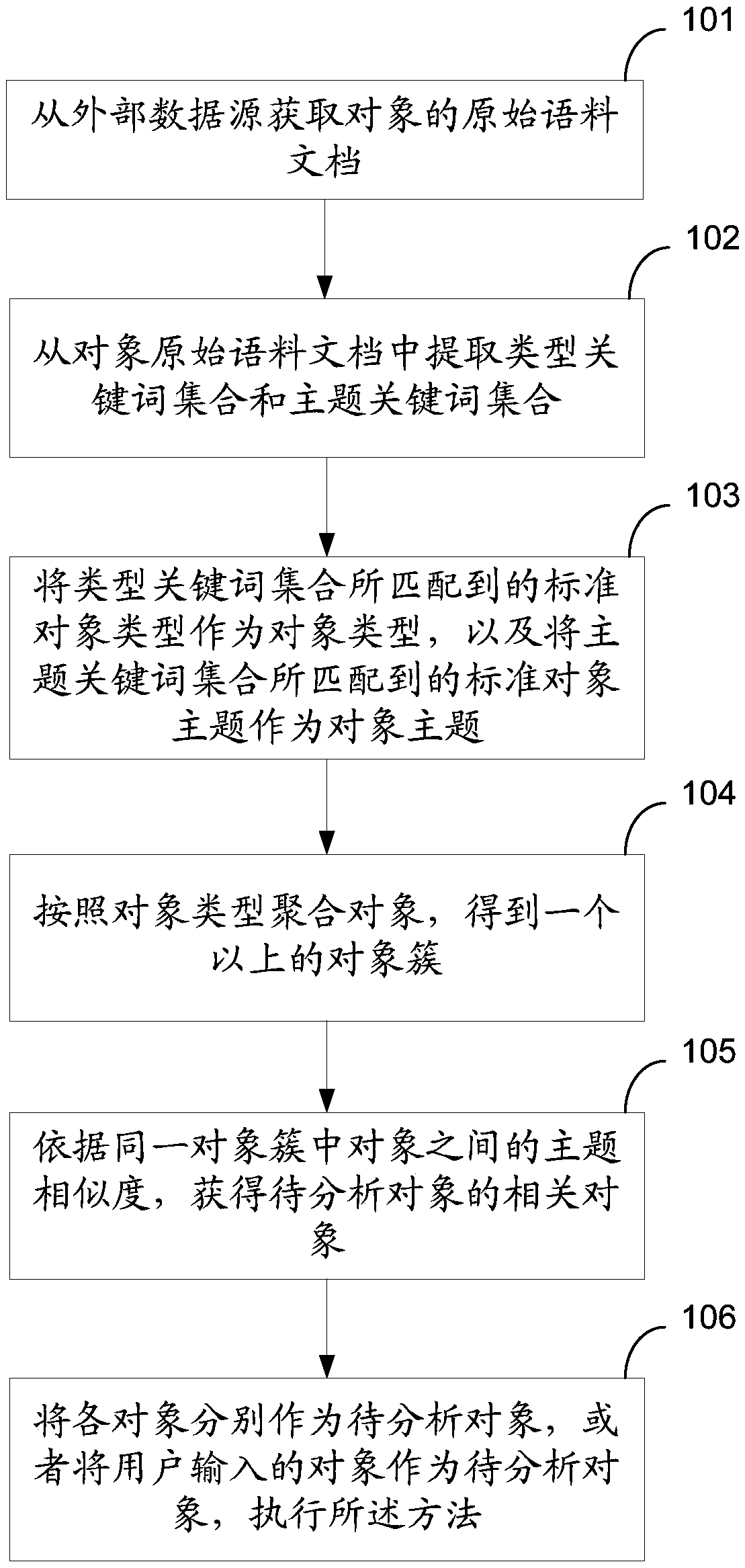

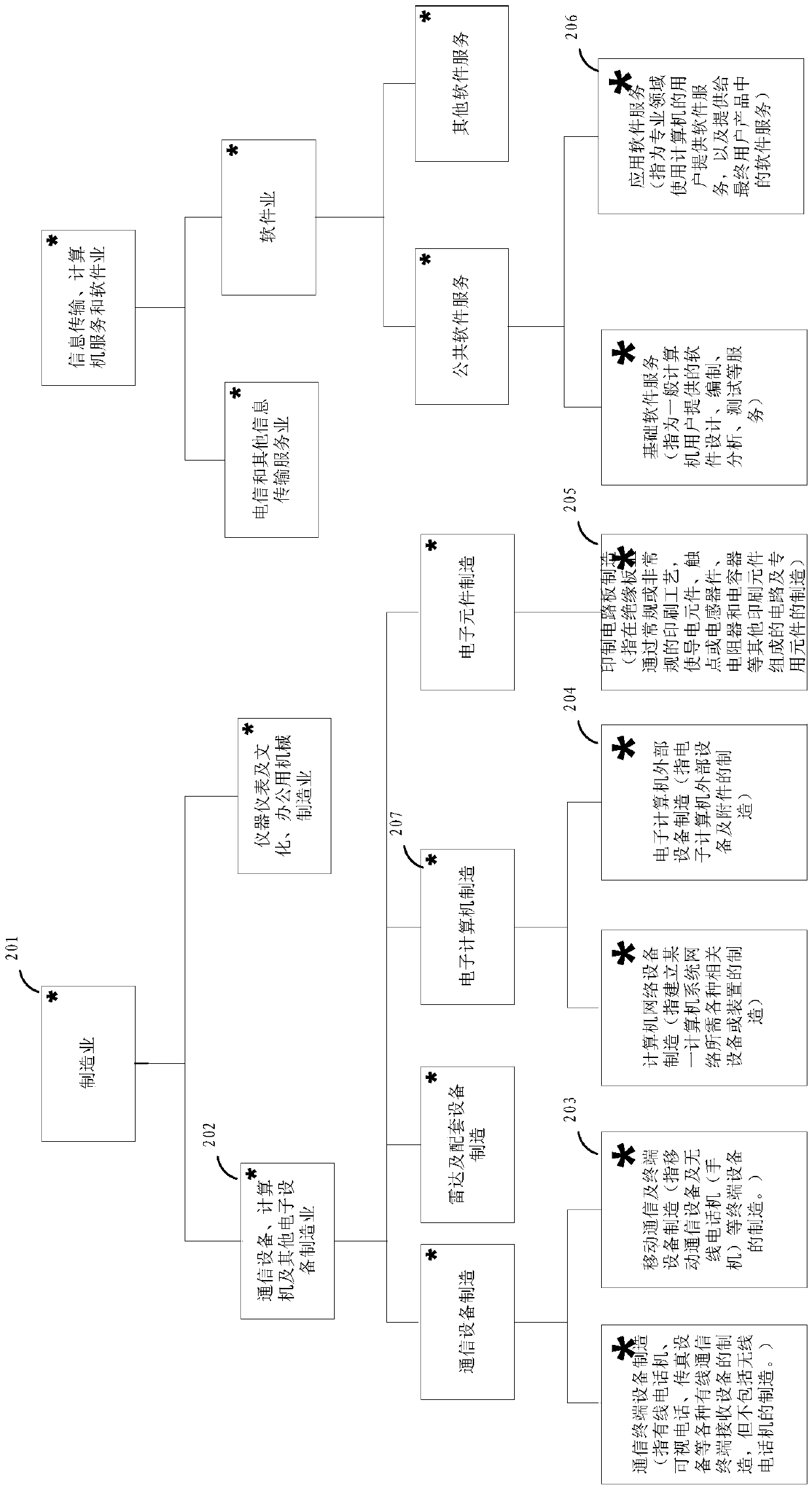

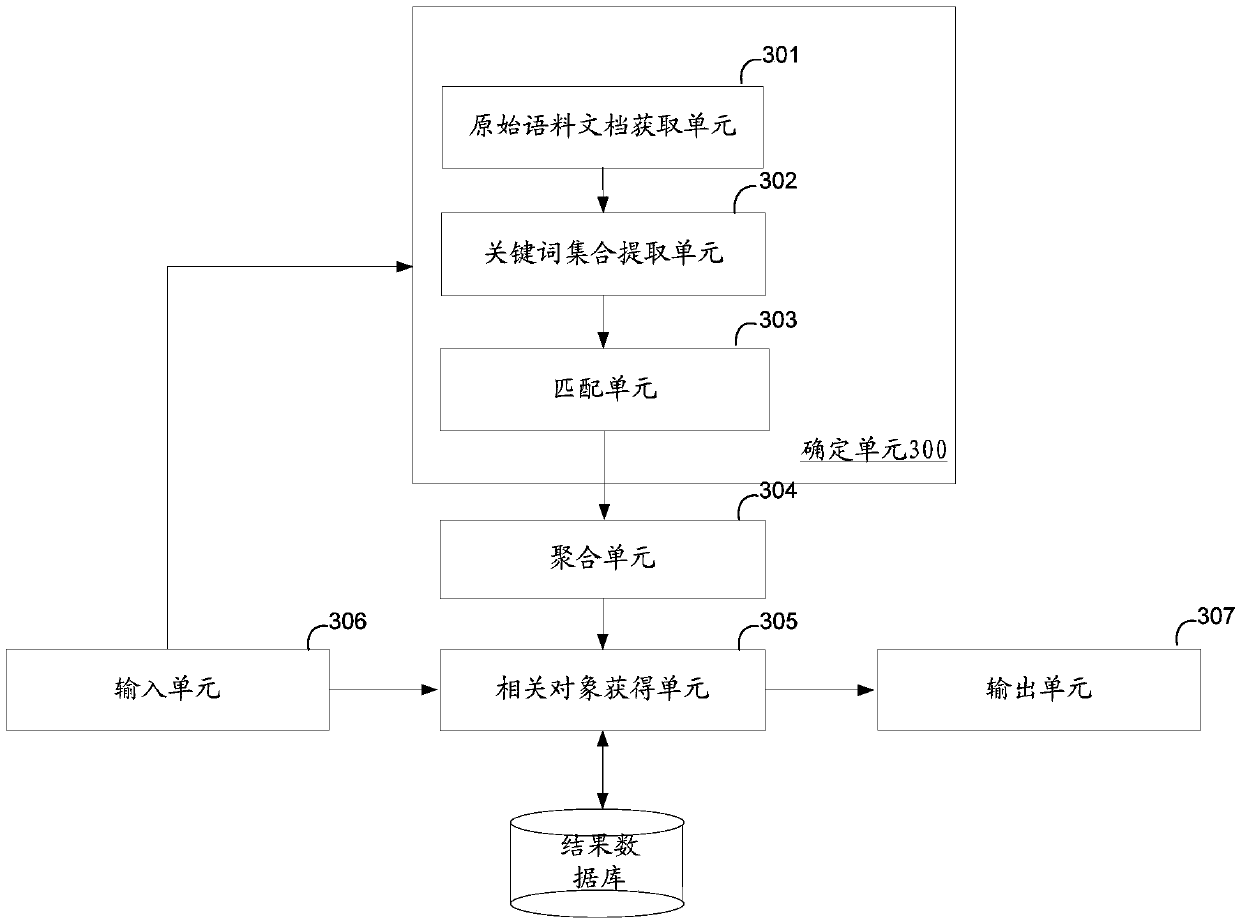

Method and device for determining related objects

ActiveCN105512270AAutomatic implementation of determinationReduce labor costsSpecial data processing applicationsText database clustering/classificationDocument preparationDocumentation

The invention discloses a method and device for determining related objects. The method for determining the related objects includes the steps that the object types and object themes of objects are determined according to original corpus documents of the objects; the objects are aggregated according to the object types, and one or more object clusters are obtained; the related objects of the to-be-analyzed objects are acquired according to the theme similarity between the objects in the same object cluster. By means of the method and device, the related objects of the to-be-analyzed objects can be automatically determined, and the defects that data analysis is conducted through an experiential analysis method in the prior art, so that too high human cost is caused, and the analysis result is limited by experience of analysts and the market activity range are overcome.

Owner:SHANGHAI YOUYANG XINMEI INFORMATION TECH CO LTD

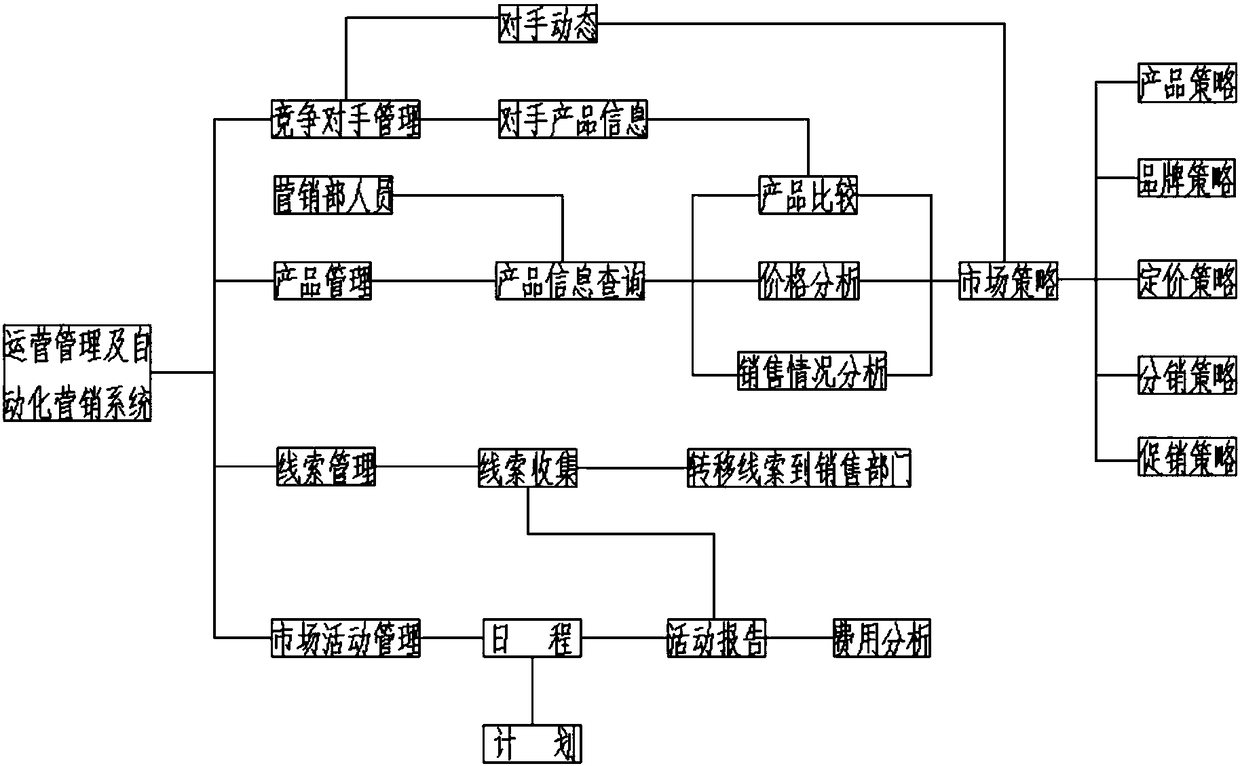

High-efficiency operation management and automatic marketing system

InactiveCN108256899AStrengthen operation managementImprove efficiencyMarket data gatheringManagement unitProduct stewardship

The invention discloses a high-efficiency operation management and automatic marketing system comprising a product management unit, a competitor management unit, a clue management unit, a market activity management unit and a marketing strategy unit. The product management unit, the competitor management unit, the clue management unit, and the market activity management unit analyze the market environment and make a market strategy. Because the product management unit, the competitor management unit, the clue management unit, the market activity management unit and the marketing strategy unitare arranged at the operation management and automatic marketing system to analyze the own products and products from competitors comprehensively and make comparison, the advantages and disadvantagesof own products are obtained and corresponding targeted strategies are made, so that the market management of the enterprise becomes systematic and the efficiency of operation management and automaticmarketing is improved.

Owner:广州瀚丰信息科技有限公司

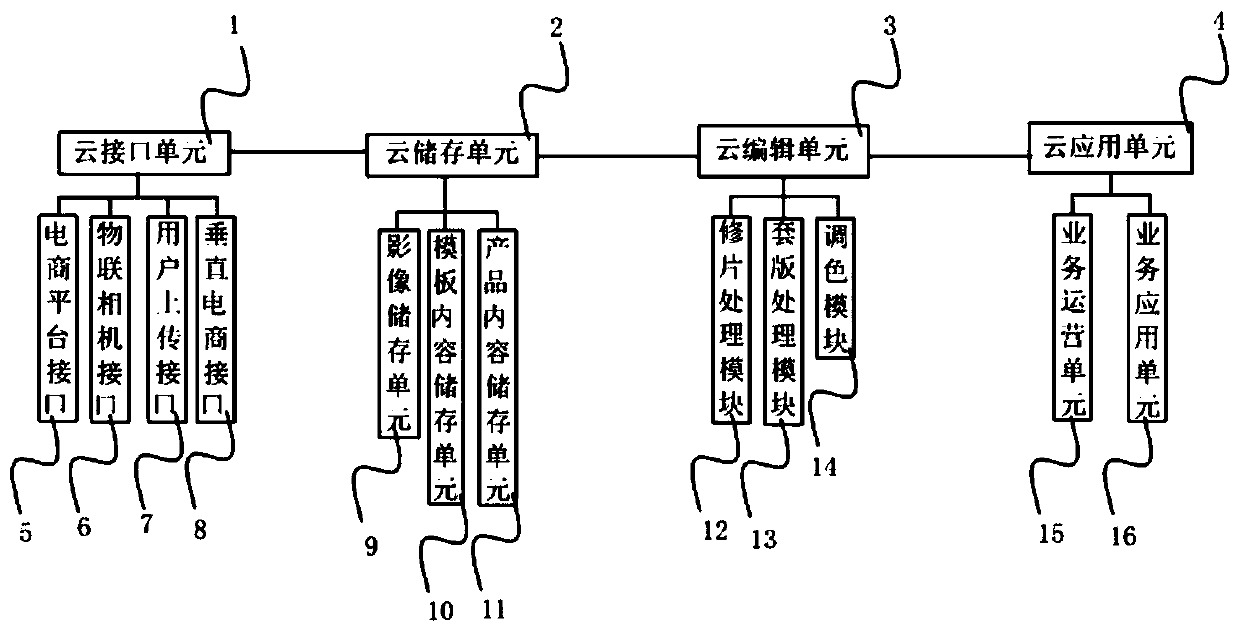

Photographing service system

PendingCN110264298AIncrease engagementImprove efficiencyBuying/selling/leasing transactionsSystems managementCloud storage

The invention relates to the technical field of services. The invention relates to a photographing service system. The system comprises a cloud interface unit, a cloud storage unit, a cloud editing unit and a cloud application unit. The photographing service system adopts the cloud interface unit to upload the photo to the cloud storage unit; the uploaded photo or video is edited through the cloud editing unit; a system tool collection platform for storage, editing processing and product production based on the Internet and the mobile Internet is provided for a user; a user can select a product through the service application unit; the participation degree of the user is improved; the user can customize the product personally through the service application unit; a manager of the system can manage commodities, manage orders submitted by clients and manage market activities through the service operation unit, and the system can be remotely controlled, so that great convenience is brought to the users, photostudios and managers of the photostudios, interests of all parties are guaranteed, and the overall efficiency of wedding photography work is improved.

Owner:鲜檬摄影有限公司

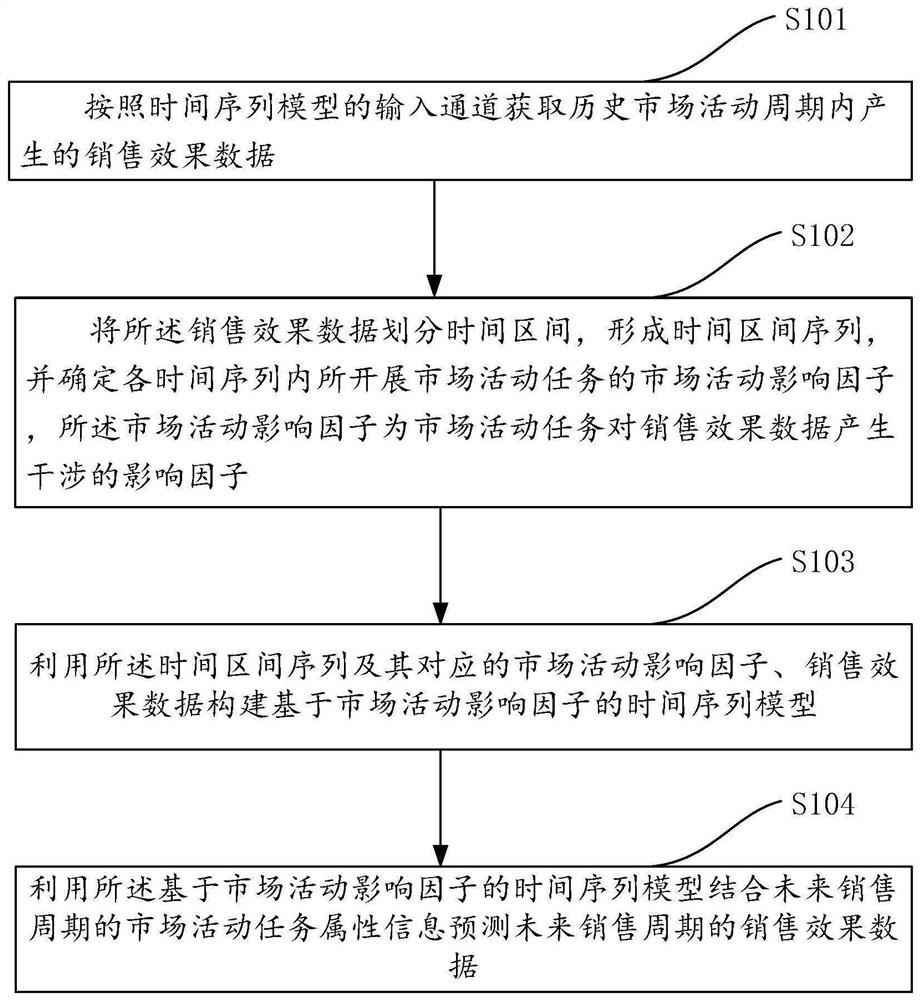

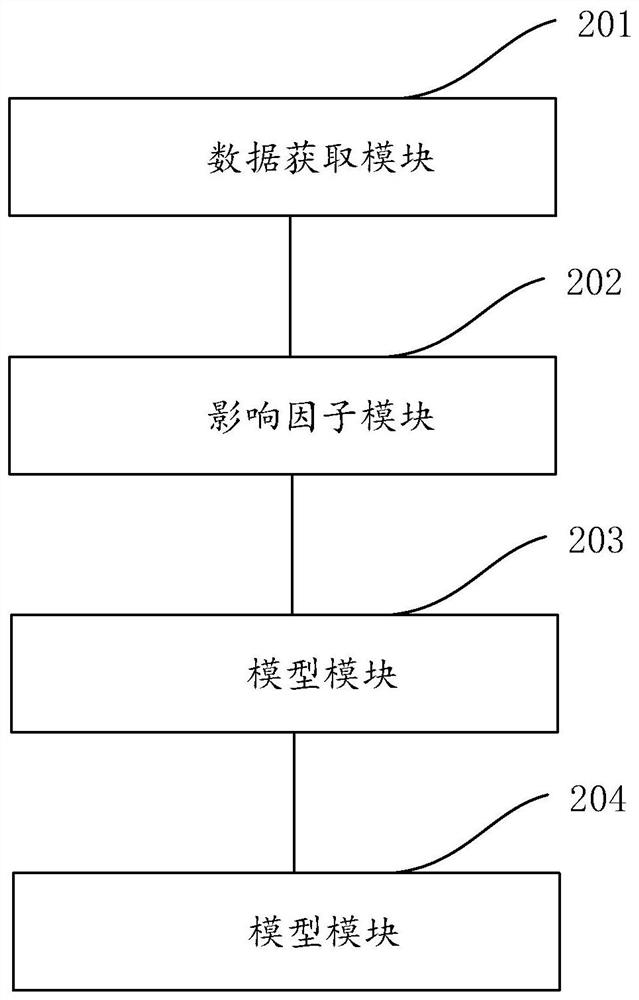

Sales effect data prediction method and device, and electronic equipment

PendingCN112686705AAvoid conversion biasIncrease flexibilityForecastingMarketingData modelingMarket place

The embodiment of the invention provides a sales effect data prediction method, and the method comprises the steps of obtaining sales effect data of a historical market activity period according to an input channel of a time sequence model, dividing the sales effect data into time intervals to form a sequence, and determining a market activity impact factor; utilizing the time interval sequence, the influence factors and the sales effect data to construct a time sequence model based on the influence factors, and utilizing the model to predict the sales effect data in combination with future market activity task attribute information. During modeling, market activity influence factors are utilized, so that the prediction process can consider the influence of market activities on sales volume; moreover, since the development of the market activity is often complex and variable, the influence factor is directly used as an independent influence factor for modeling and prediction instead of other factors indirectly reflecting the influence of the market activity, the deviation of indirect factor conversion is avoided, and during prediction, accurate prediction can be performed by directly adjusting the model input based on a market activity, so that flexibility and accuracy are improved.

Owner:上海画龙信息科技有限公司

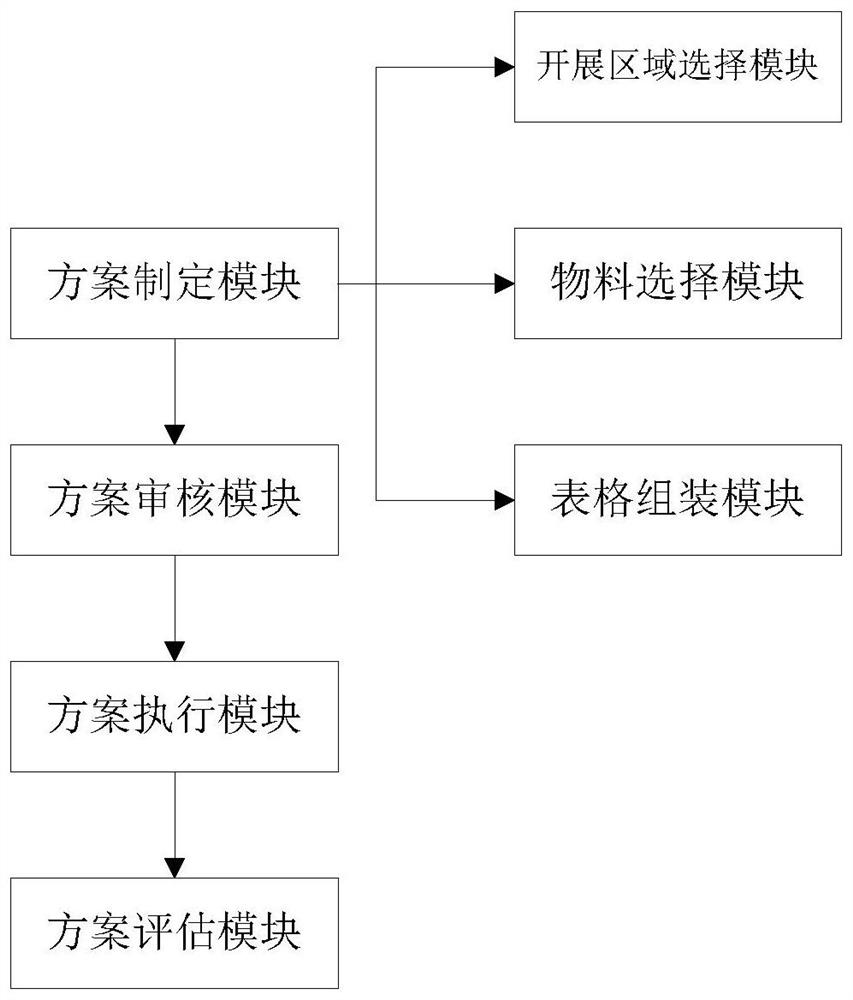

Scheme planning system and method for launching marketing activities in cities and counties throughout China

InactiveCN111798218AApproval is convenient and fastImprove work efficiencyOffice automationResourcesSoftware systemMarket place

The invention discloses a scheme planning system and method for launching marketing activities in cities and counties throughout China, belonging to the field of software systems. The technical problem to be solved by the invention is how to completely record the whole process of marketing activity scheme planning while realizing convenient and fast examination and approval, thereby guaranteeing that a reference can be provided for subsequent similar activities, and being capable of improving the working efficiency. The scheme planning system is characterized by comprising a scheme making module, a scheme auditing module, a scheme execution module and a scheme evaluation module, wherein the scheme making module is used for filling and reporting marketing activity schemes, submitting the marketing activity schemes to a background in a form submitting mode, and realizing data storage through using a springMVC three-layer architecture; the scheme auditing module is used for auditing the schemes by auditors at all levels; the scheme execution module is used for executing and summarizing the schemes by execution personnel in cities or counties; and the scheme evaluation module is used for summarizing summaries submitted by each launching region by the submission personnel.

Owner:INSPUR SOFTWARE CO LTD

Financial data entry system

A method of tracking and aggregating all Securities and Exchange Commission (SEC) “shelf” registration and all capital market activity related to those shelf registrations. The method includes the steps of accessing a first database containing data associated with investment registrations, wherein the data is organized as a series of individual filings. The method further includes the steps of retrieving data from the first database associated with selected ones of the filings, organizing the data into tables based on at least one aggregate aspect of the data common to multiple filings, and storing the retrieved data in at least one table.

Owner:RILEY CHARLES A

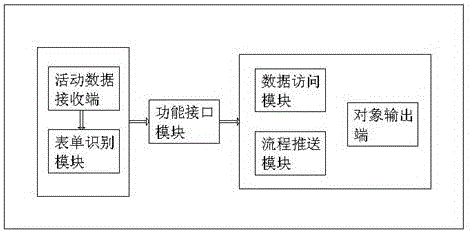

Integrated system used for managing market activity flow charts

InactiveCN106203871AImprove propulsion efficiencyImprove noveltyResourcesData accessComputer science

The invention discloses an integrated system used for managing market activity flow charts. An active data reception end is for receiving sensor data associated with market activities. A chart identification module is for identifying multiple flows on a flow chart. A data access module is for supporting a computer configured with simulation operations to read and write data of the flow chart. A flow push module is for pushing the flow chart to the computer. An object output end is for outputting a report formed by object data and a flow push sequence generated by simulating activities on the computer. The integrated system combines current activity data with previous activity feedback reports to generate an activity flow chart, and carries out activity simulation according to the push sequence to output the optimal activity flow push report, and thus the flow propulsion efficiency is greatly improved, and the integrated system can be widely applied to the field of market activity flow chart management.

Owner:太仓安顺财务服务有限公司

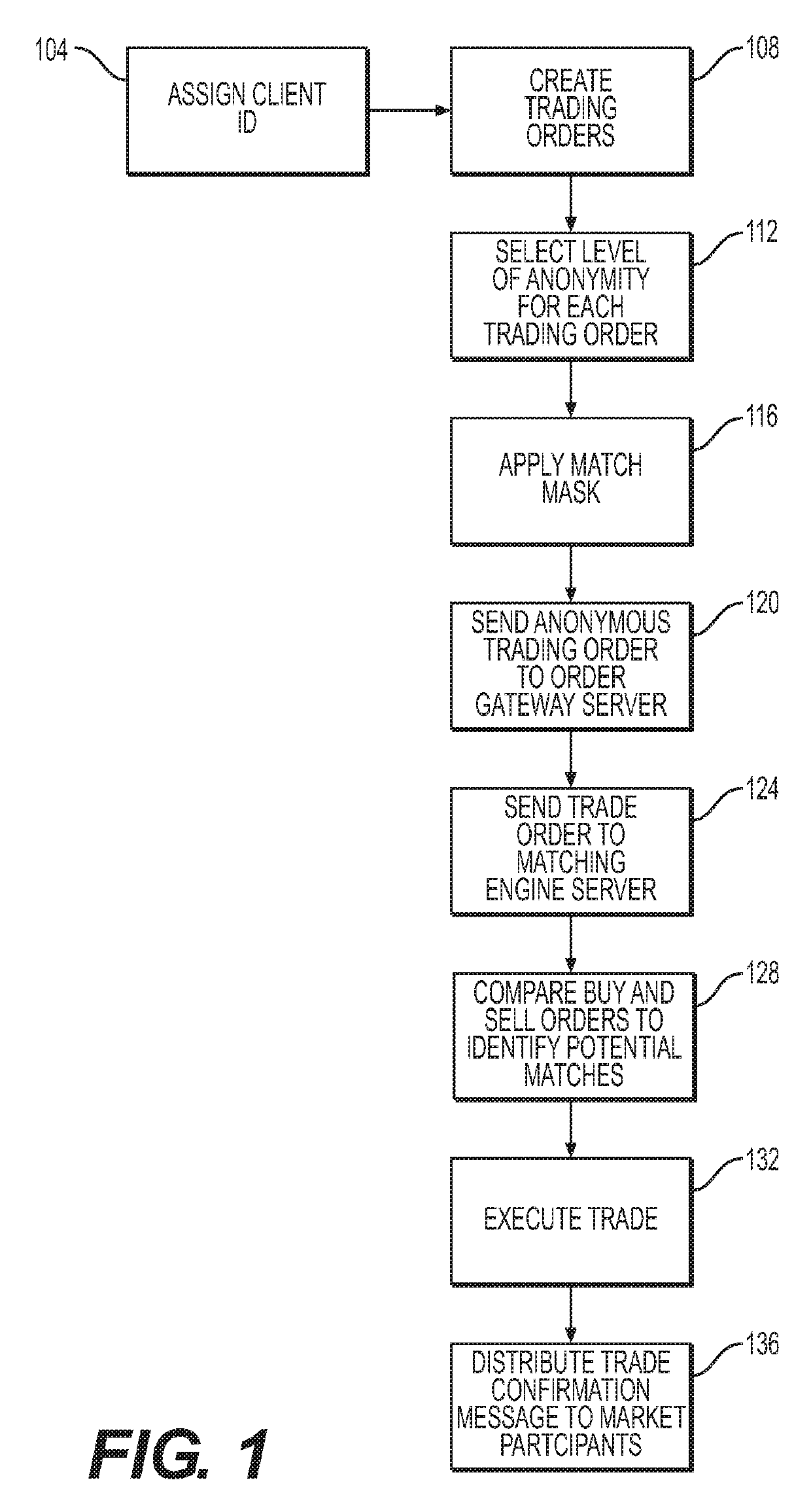

Interacting anonymously in a network market

An anonymous and selective networked trading market utilizing a match masking application is described. Clients maintain anonymity through the use of a unique client identifier or an anonymous client identifier. The networked market system allows both selective trading and anonymity through the use of client-created match masks, which provide the trader the ability to select trading partners and tailor each trade to a variety of client-specified requirements. Encoding of match masks and matching of match masks is described. The system further allows clients to adjust future trading parameters based on analysis of previous market activity, which creates a level playing field for all traders. The system allows clients to create and adjust their trading orders without third-party intervention on a distribution network, which provides clients the flexibility to trade with only those other traders who meet their specifications. Tailored masks are applied to orders and match masking is used to match buy and sell orders selectively and anonymously. This is particularly useful in a networked trading systems such as currency trading, commodity trading, and the like.

Owner:GILMAN SEAN

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com