Patents

Literature

88 results about "Clearing price" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

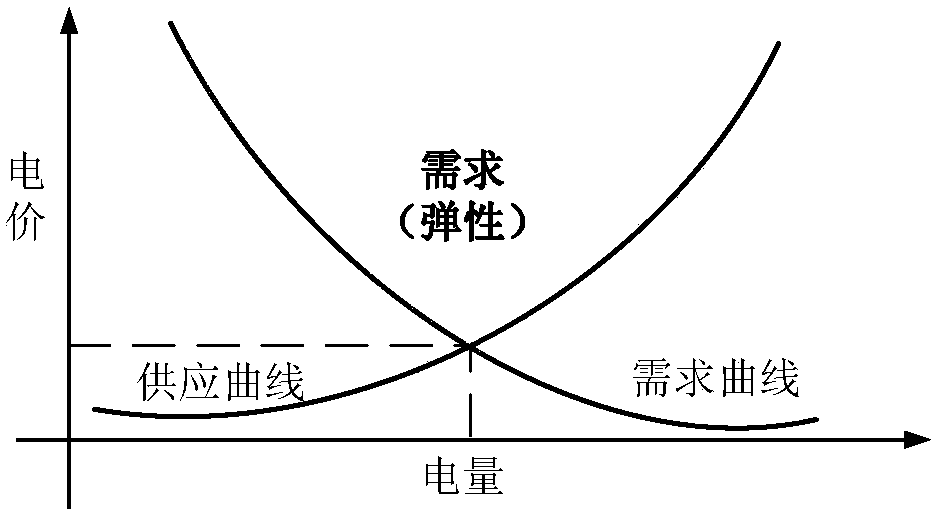

Clearing price. Definition. The price assigned to an asset after buyers have completed the bid and ask process. The clearing price represents the highest negotiated price that the buyer is willing to pay and the lowest price that the seller is willing to take.

Boundary Constraint-Based Settlement in Spread Markets

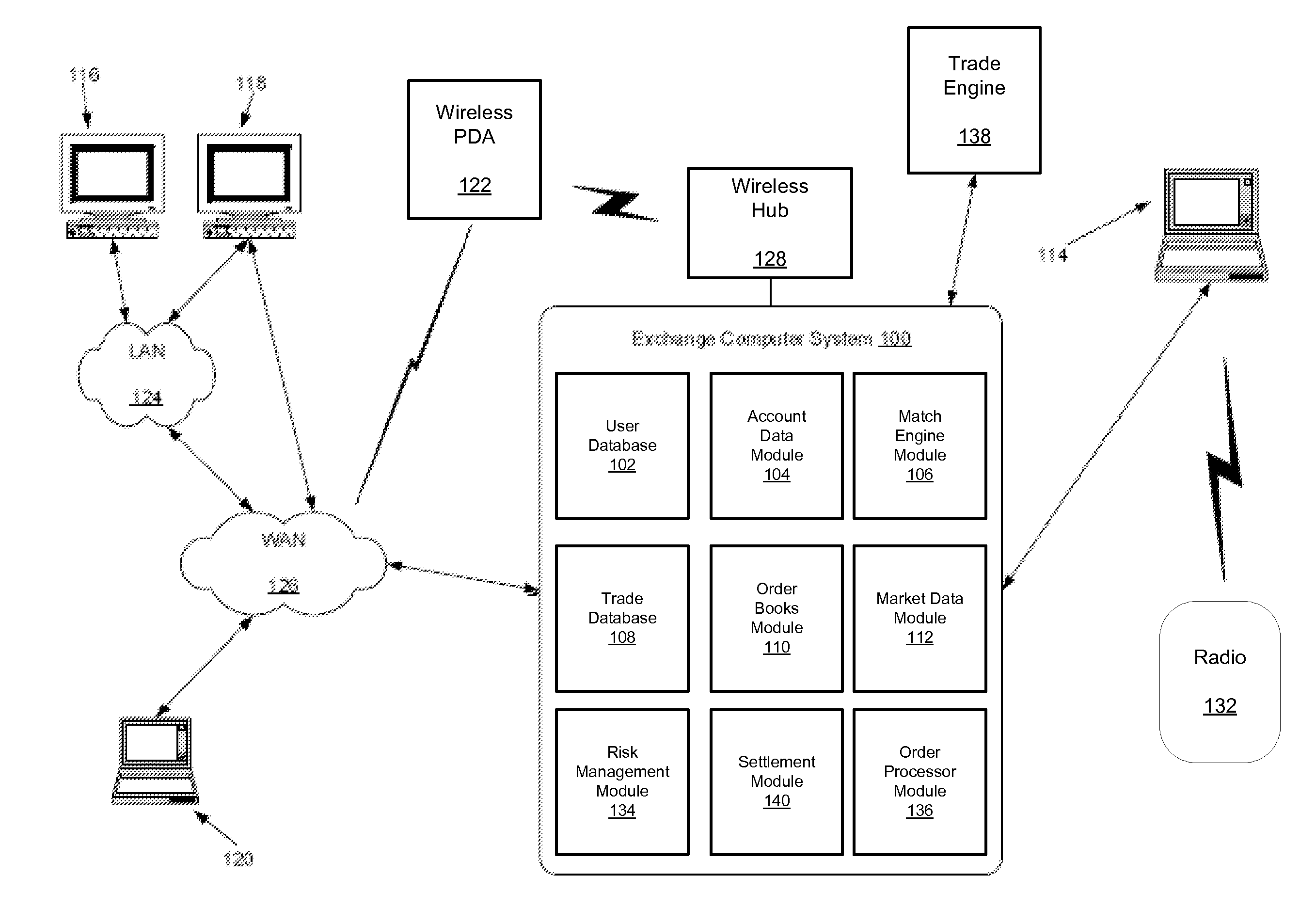

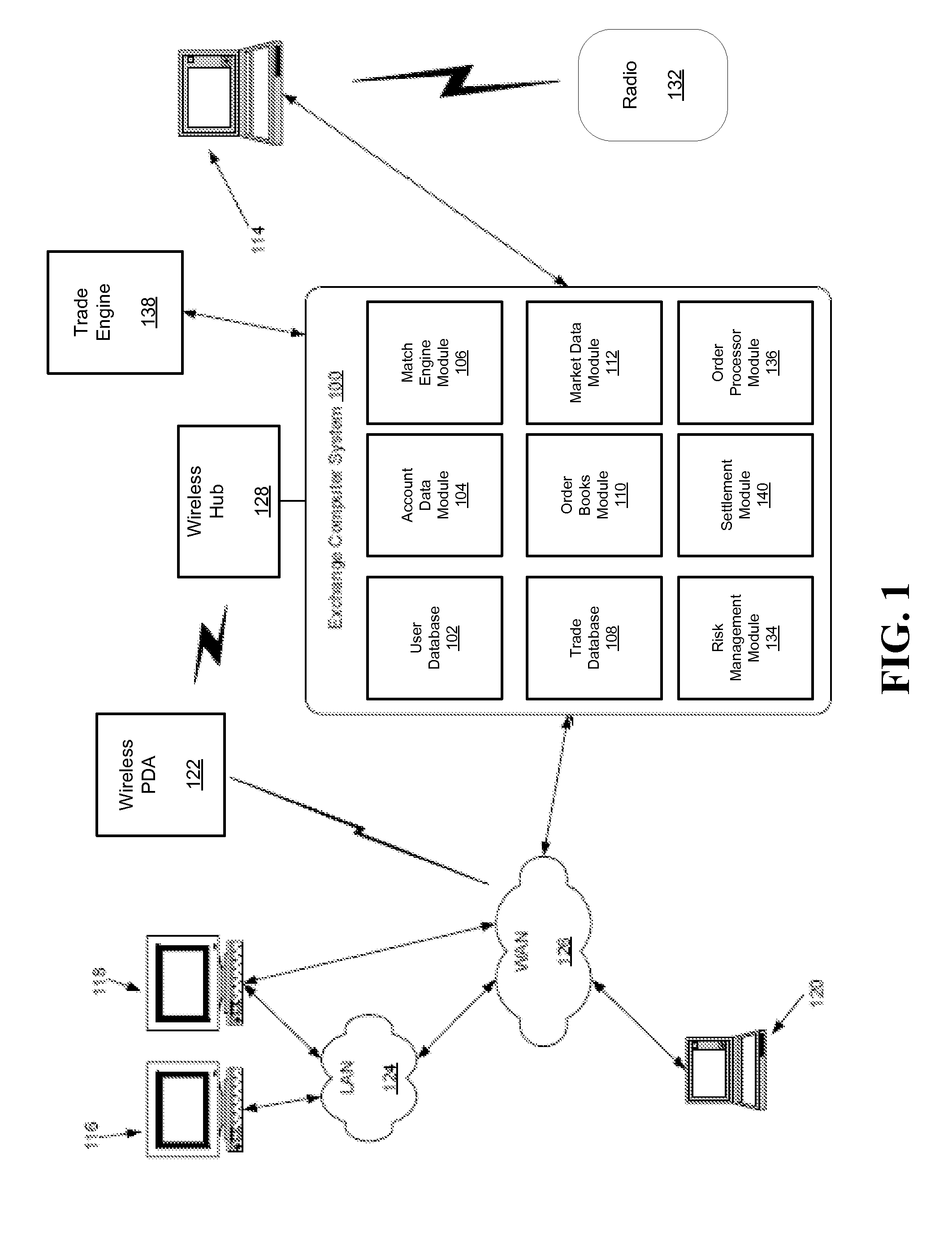

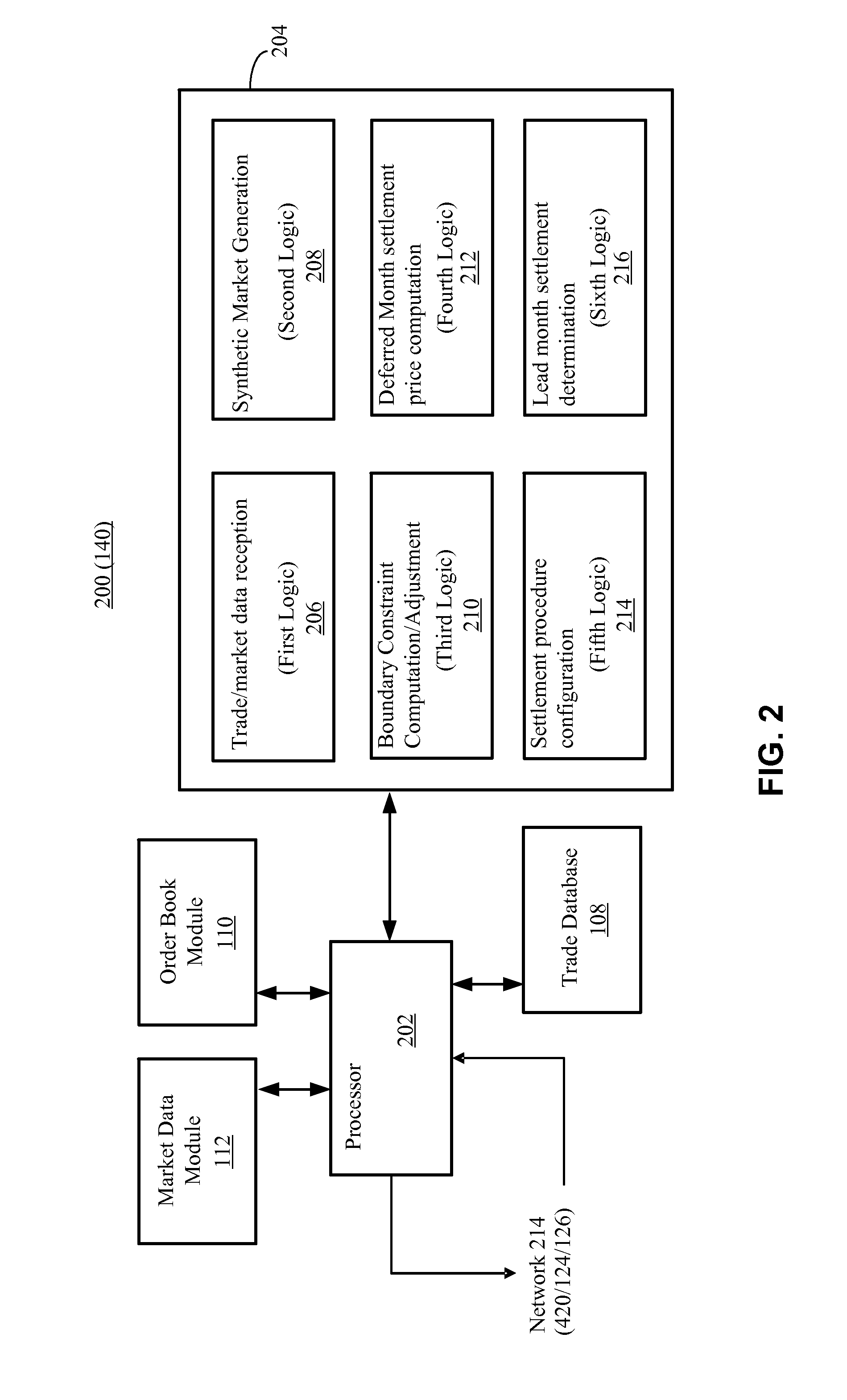

A computer implemented method determines a settlement price for a constituent contract of a plurality of spread instruments. The method includes obtaining market data indicative of bid-offer values for the plurality of spread instruments, generating synthetic market data for the constituent contract based on the bid-offer values and based on a respective settlement price for an active contract of each spread instrument of the plurality of spread instruments, determining boundary constraints on the settlement price for the constituent contract based on the synthetic market data, and computing the settlement price for the constituent contract based on the boundary constraints.

Owner:CHICAGO MERCANTILE EXCHANGE

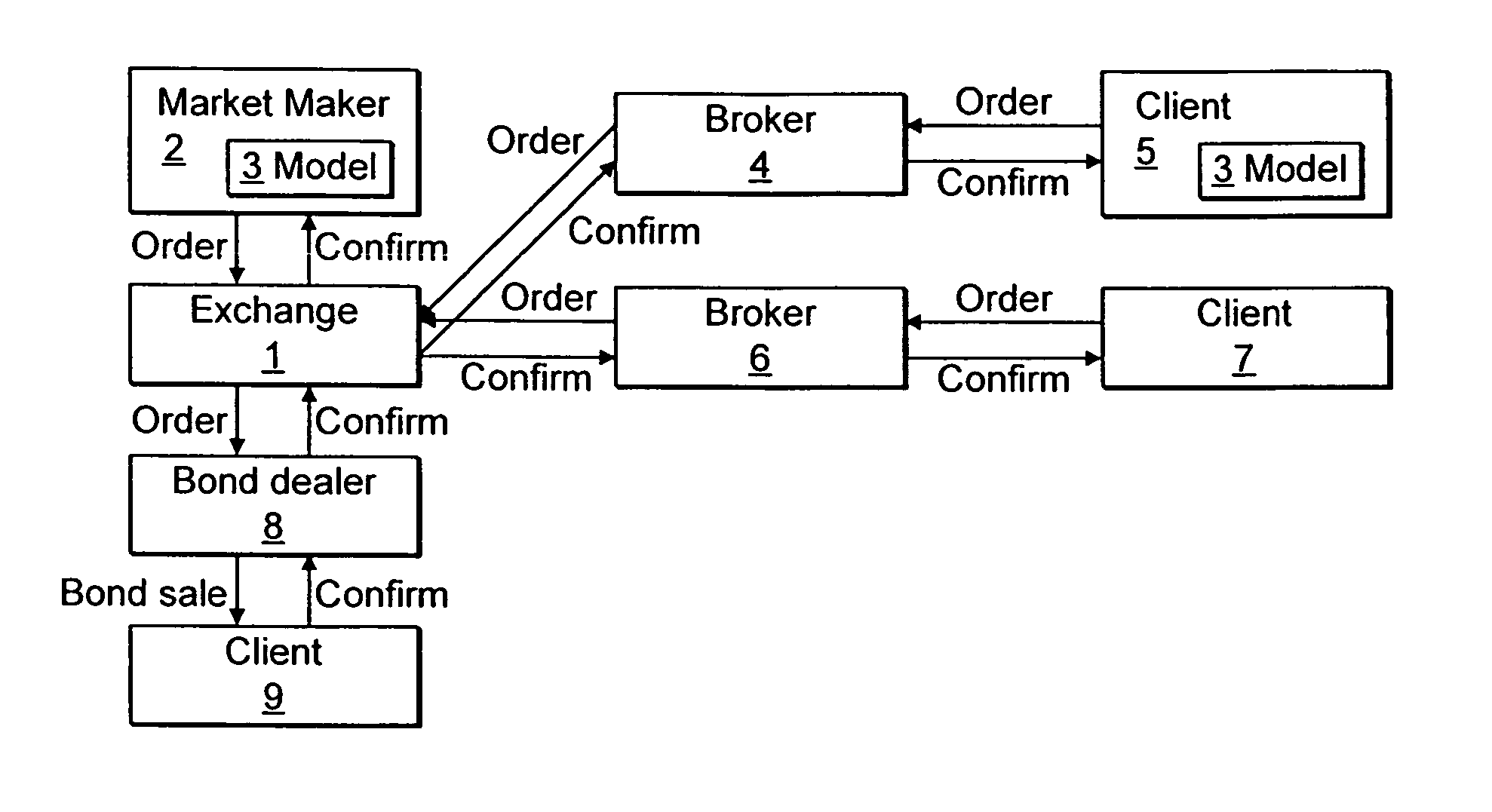

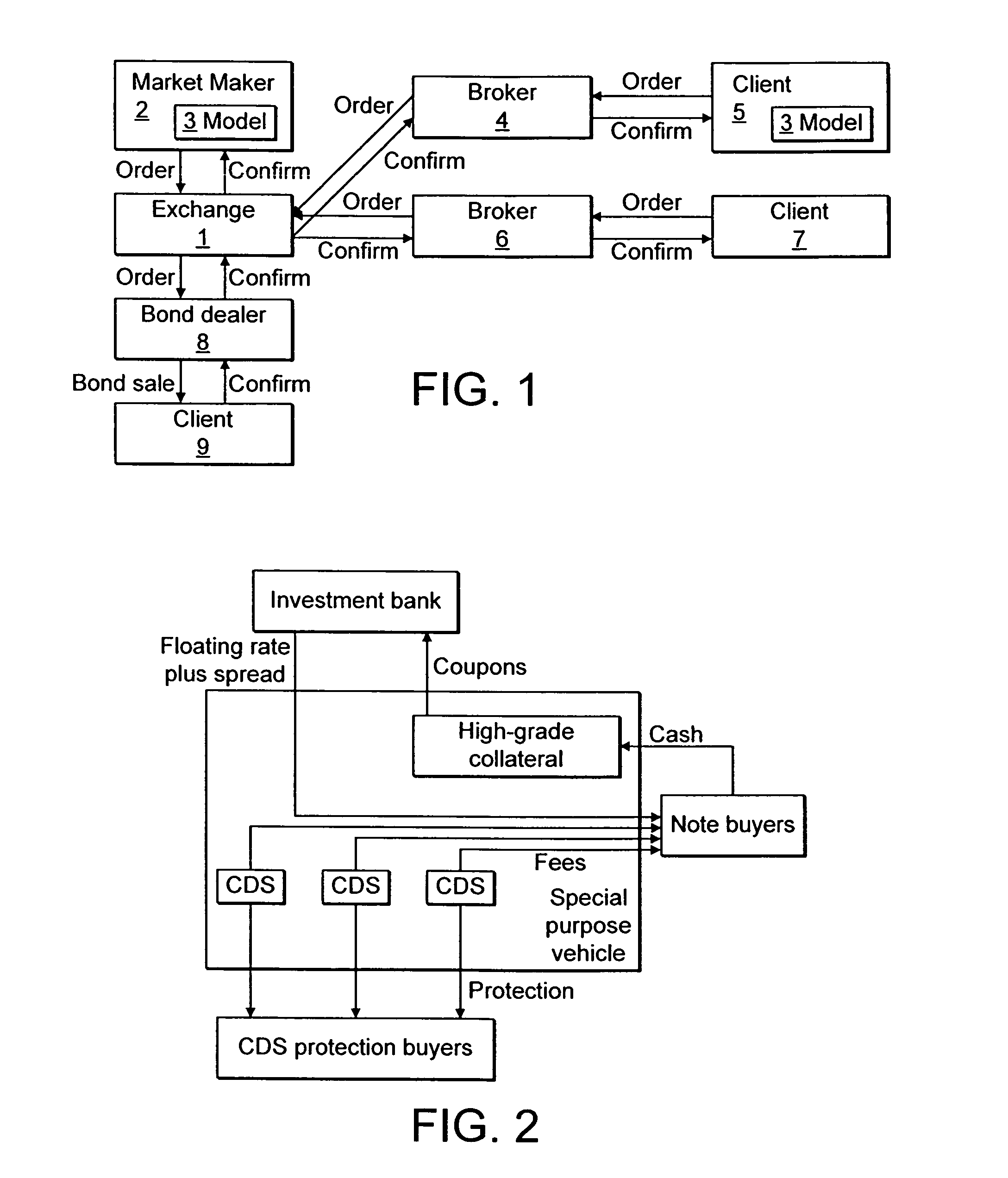

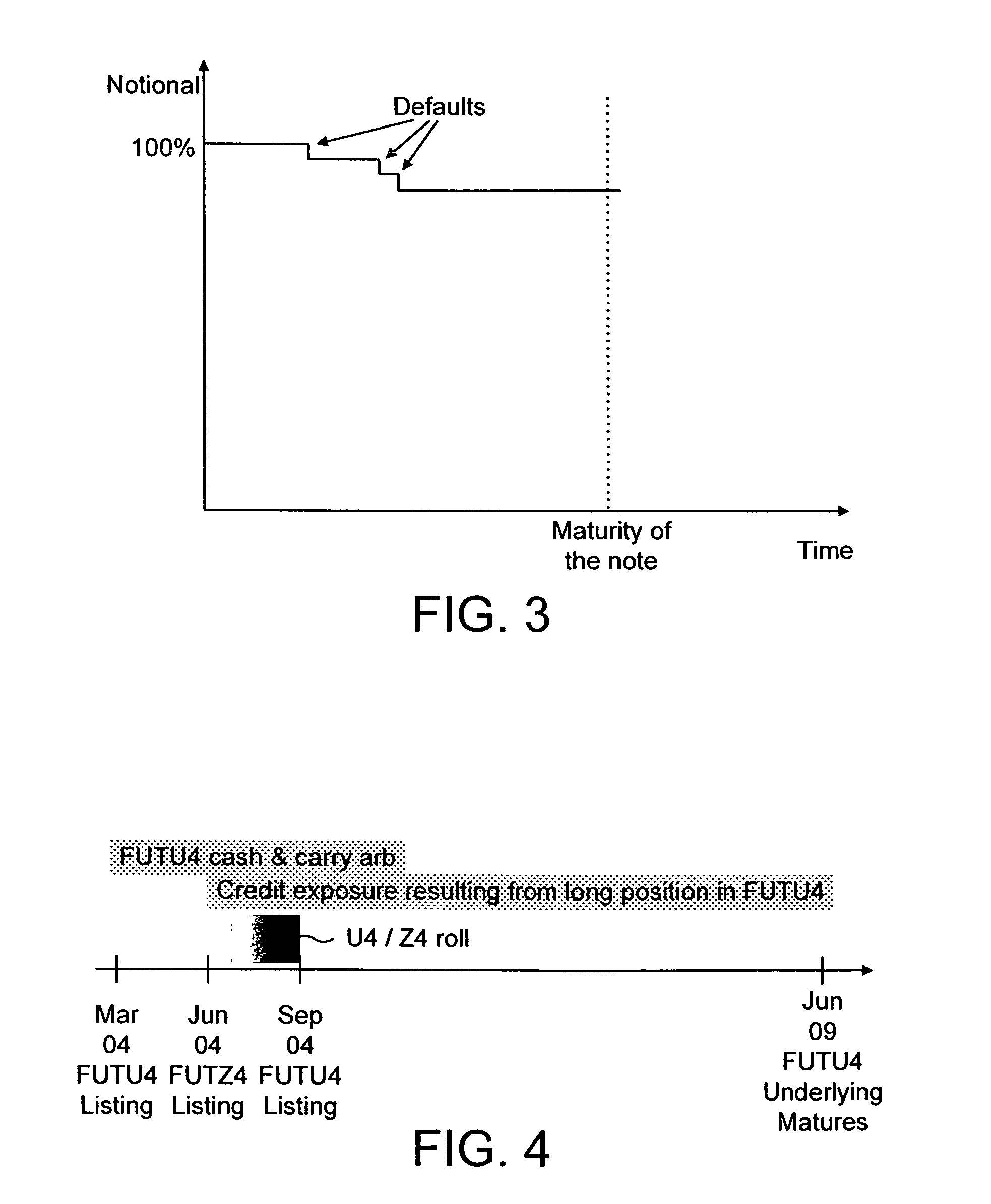

Method, system, and computer program product for trading diversified credit risk derivatives

InactiveUS20050080734A1Improve liquidityWide accessFinancePayment architecturePaymentConversion factor

A method and apparatus for trading a standardised contract. The contract obliges the seller to make delivery to the exchange of a standardised debt product on the delivery date of the contract for a price given by the exchange determined settlement price and a conversion factor. The contract further requires to take delivery from the exchange of said debt obligation for the same price. The contract further requires the buyer or seller to make margin payments to the exchange on each trading day, or with a longer period, based on the price movements of the contract during that trading day or period if so required by the trading rules. The contract further obliges the exchange to make similar payments to the buyer or seller if they are entitled to such payments under the trading rules.

Owner:DEUTSCHE BANK

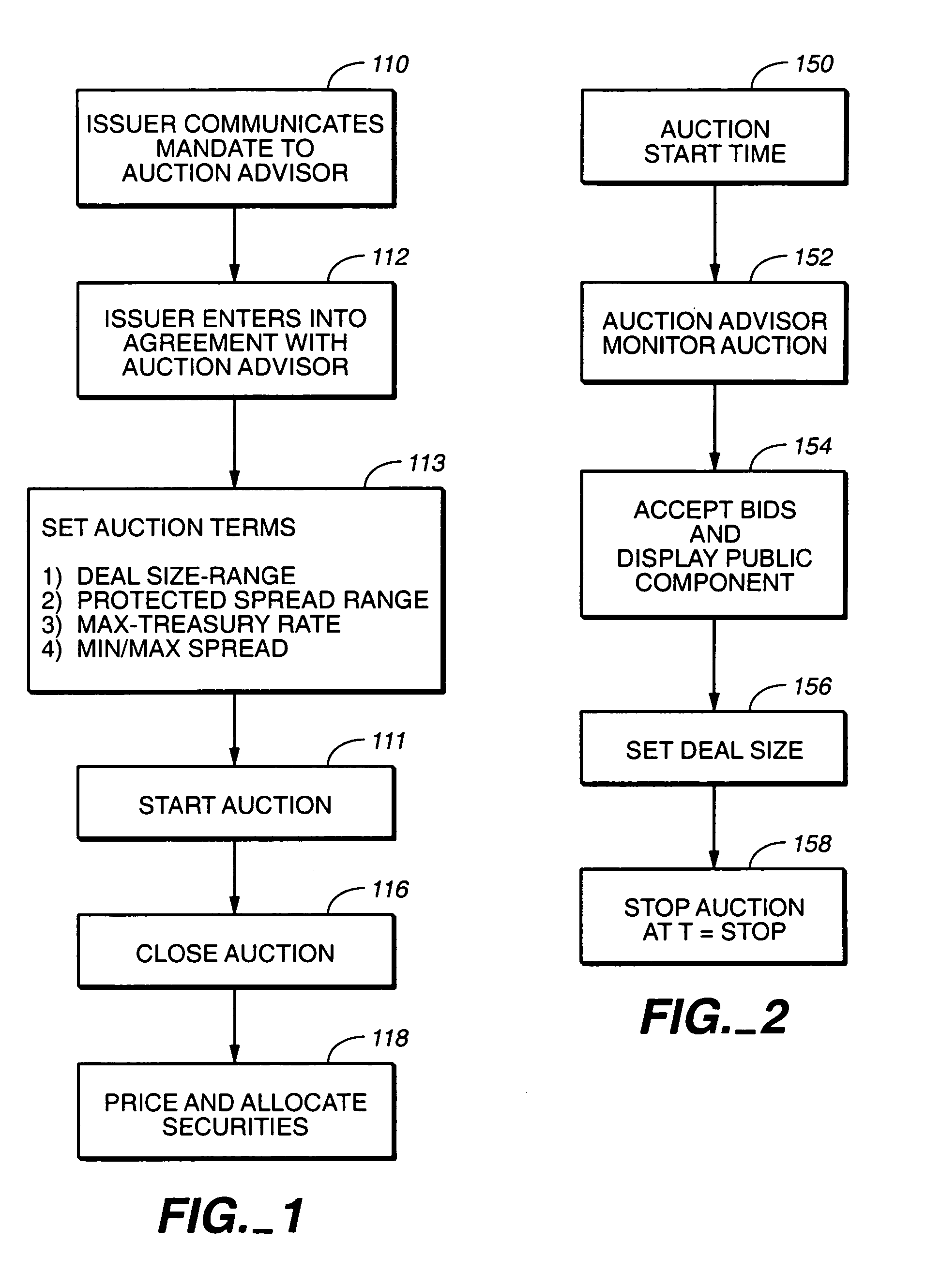

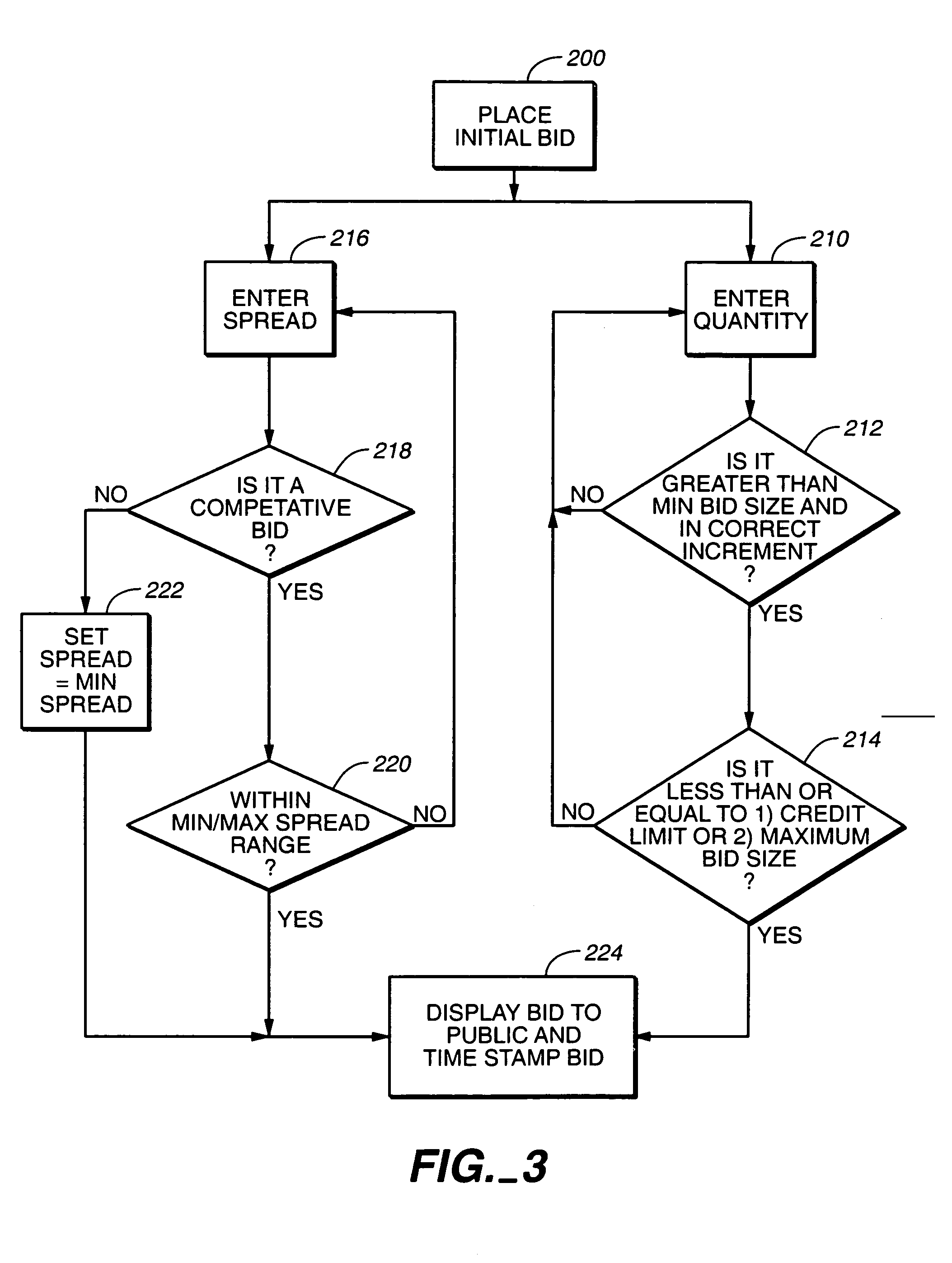

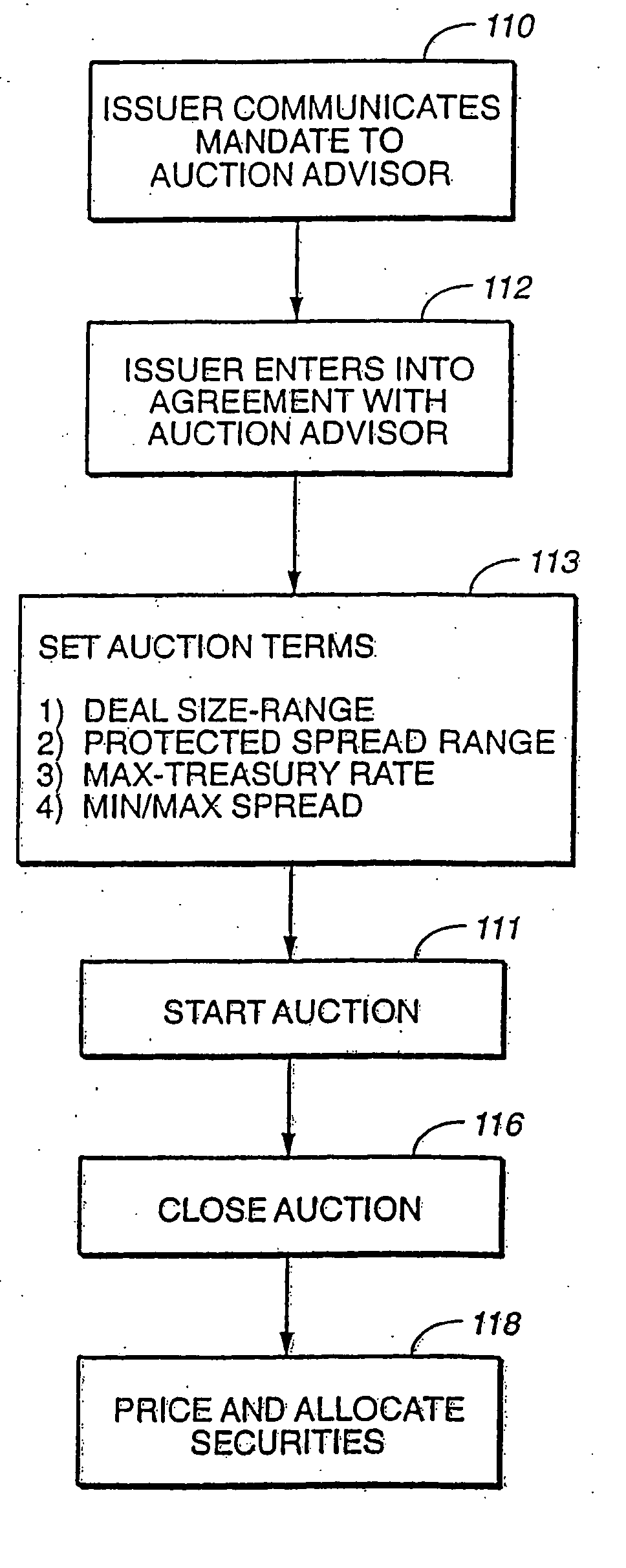

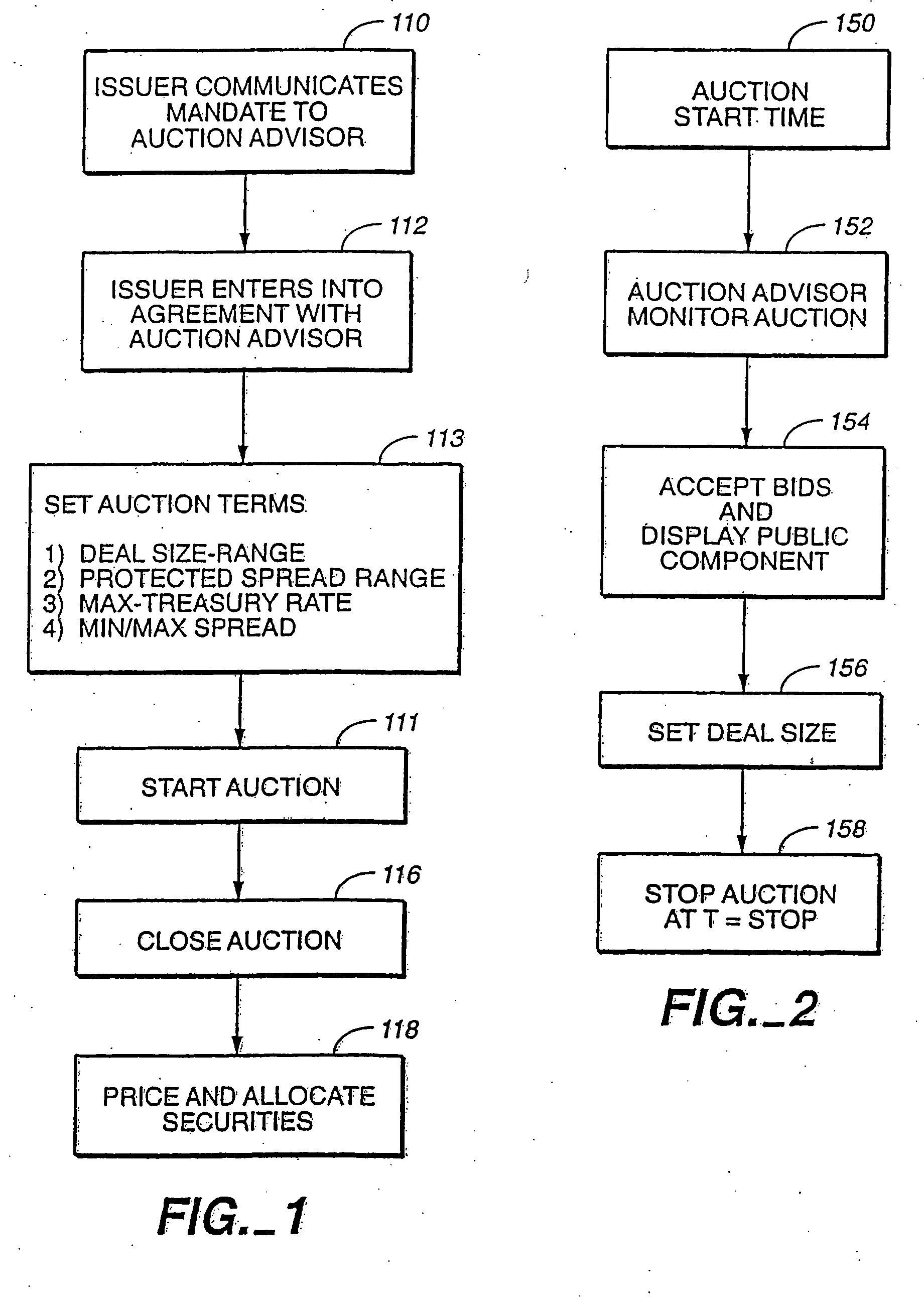

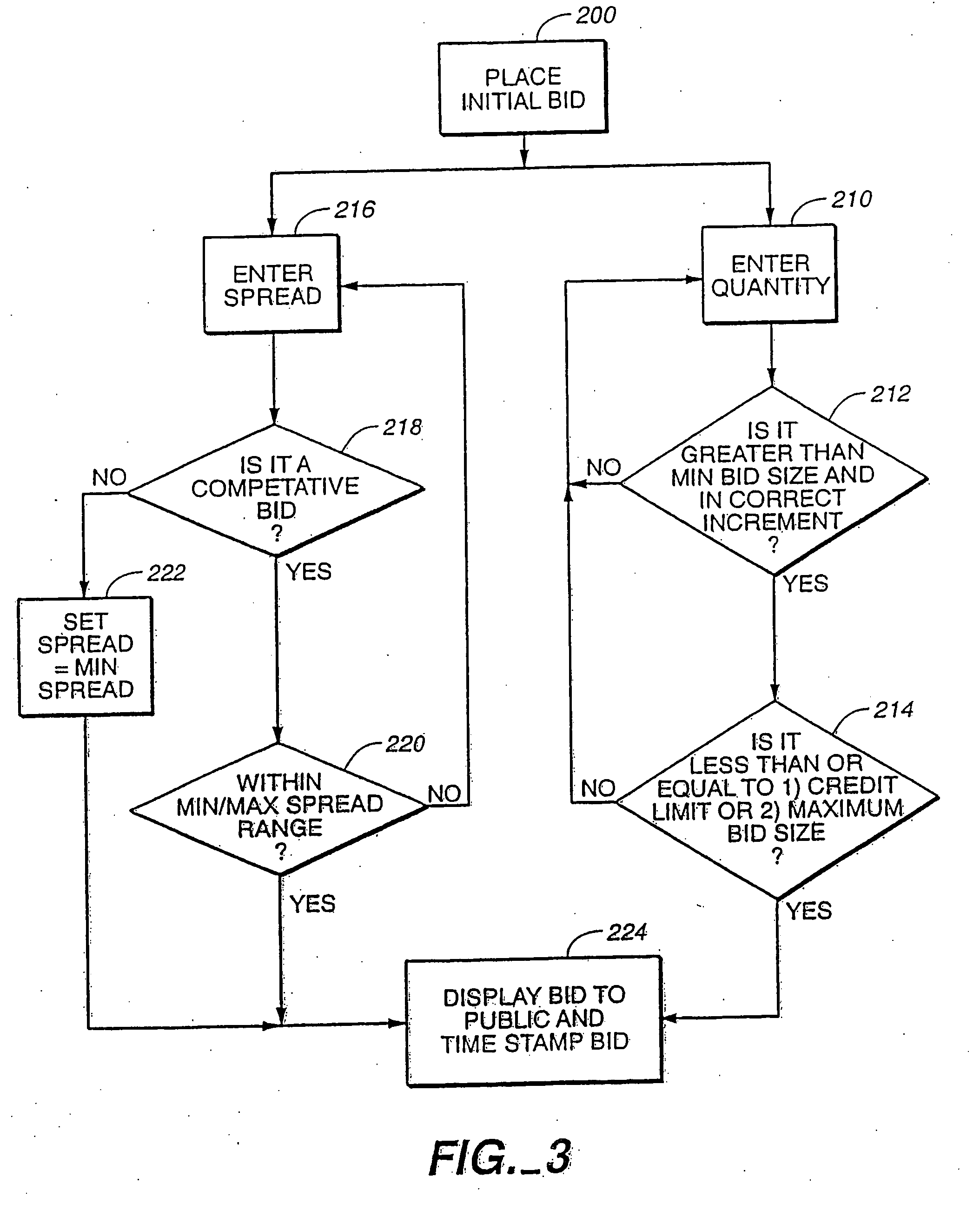

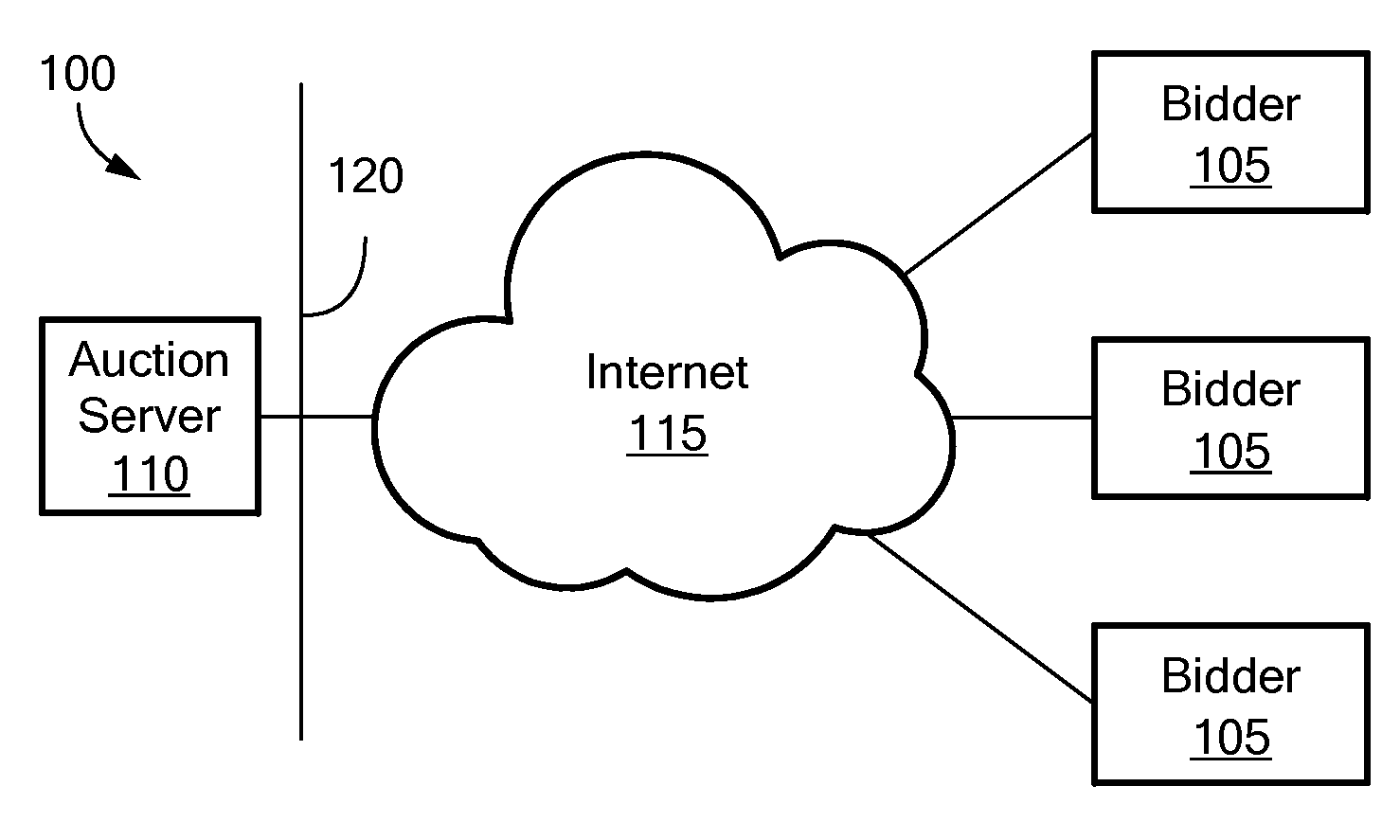

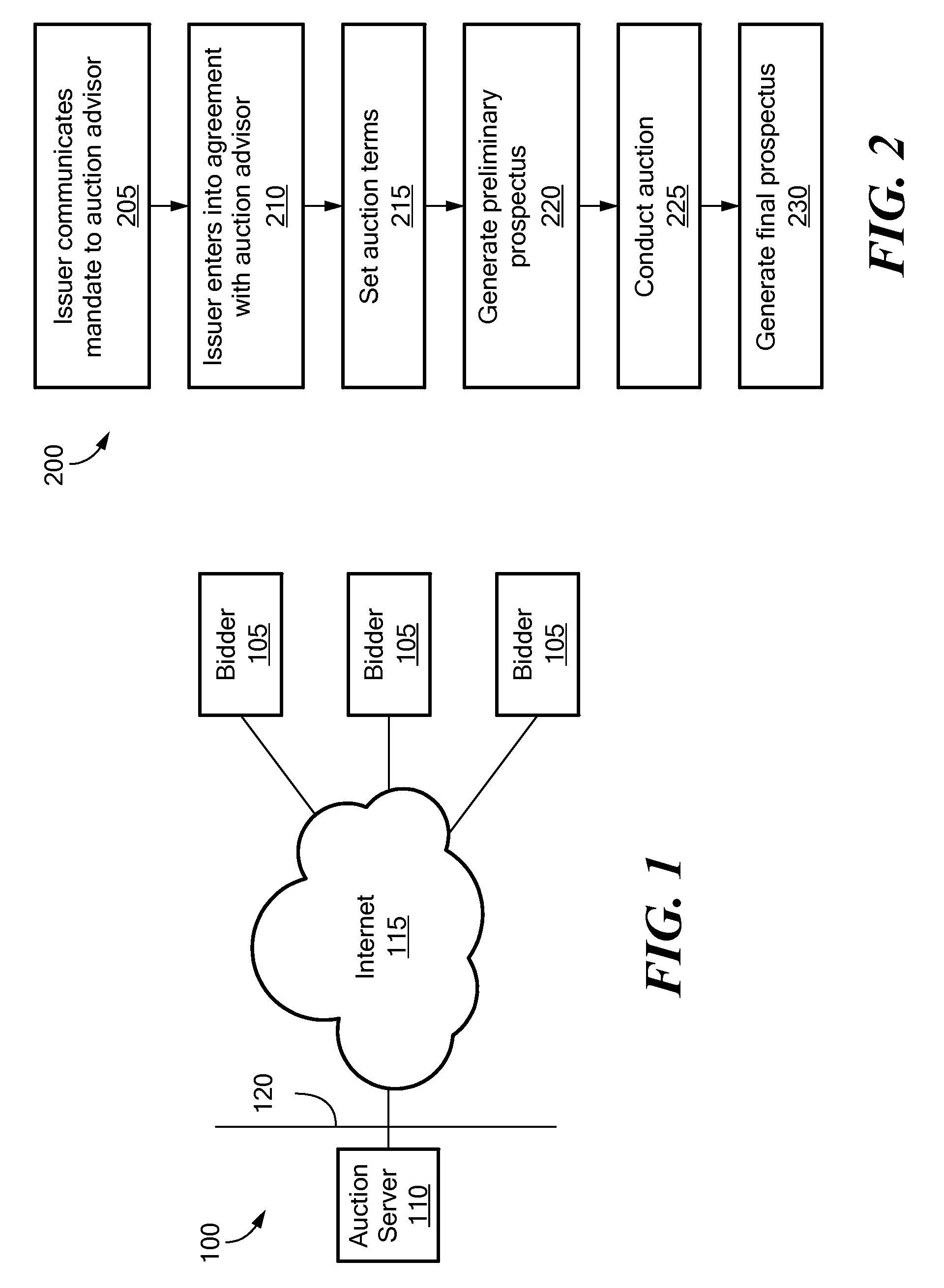

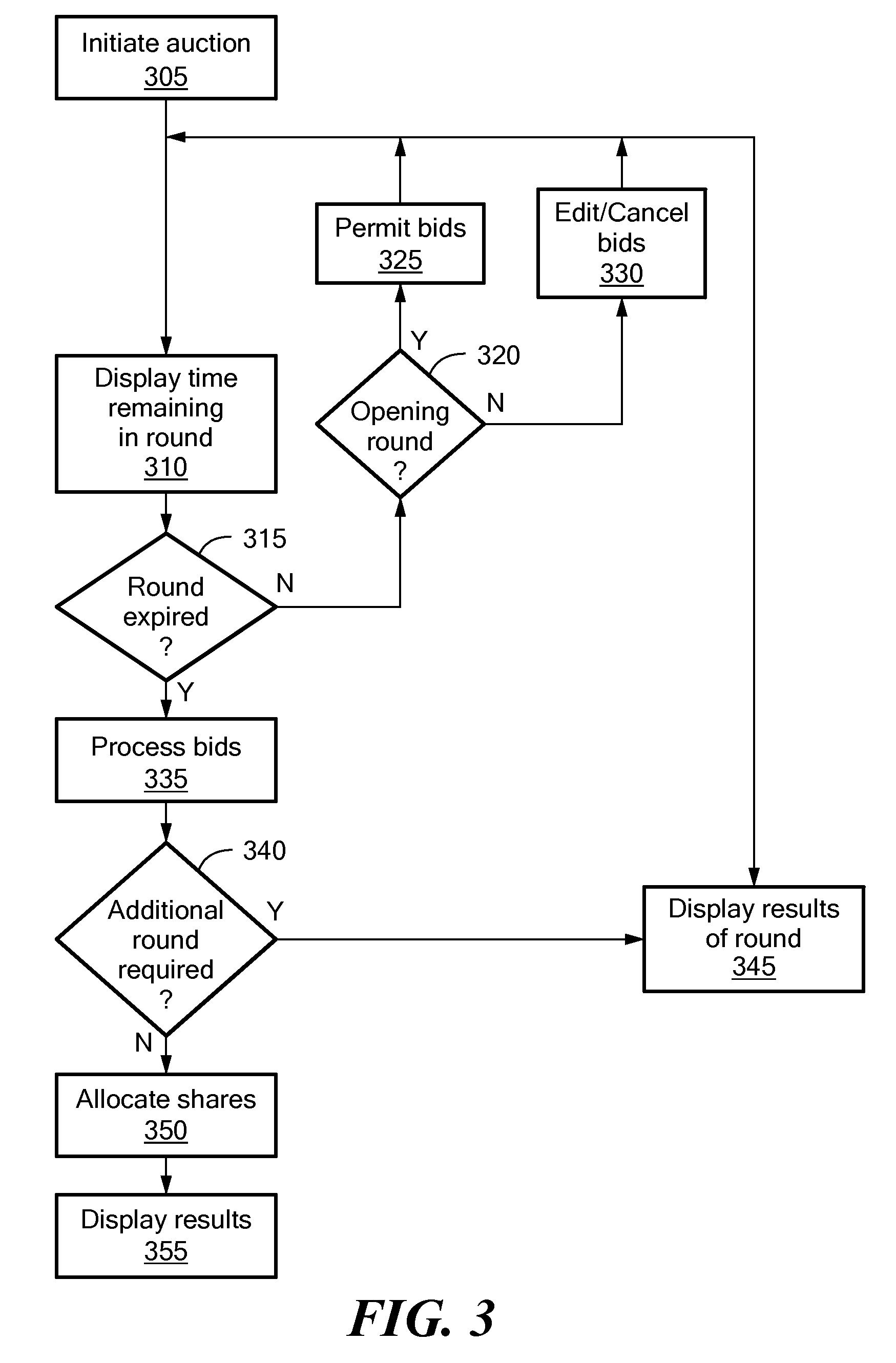

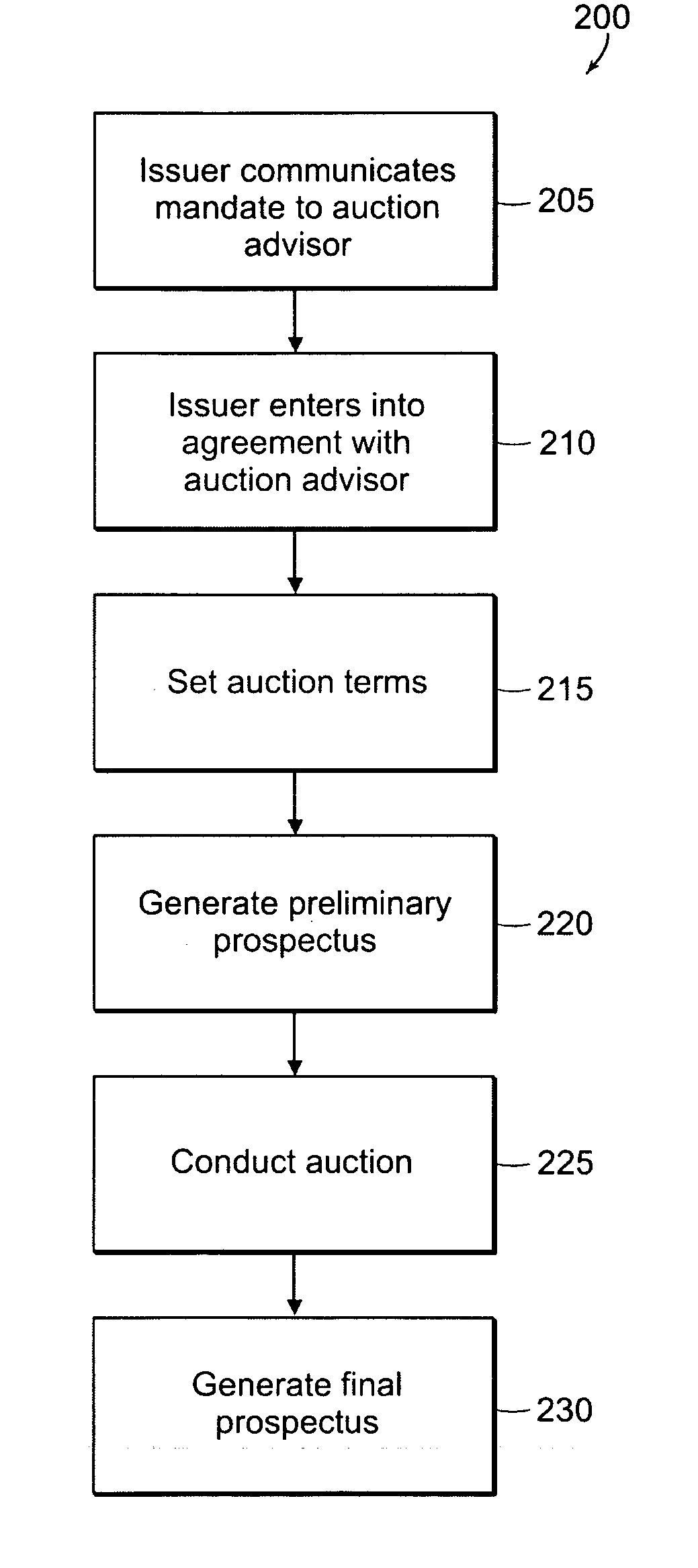

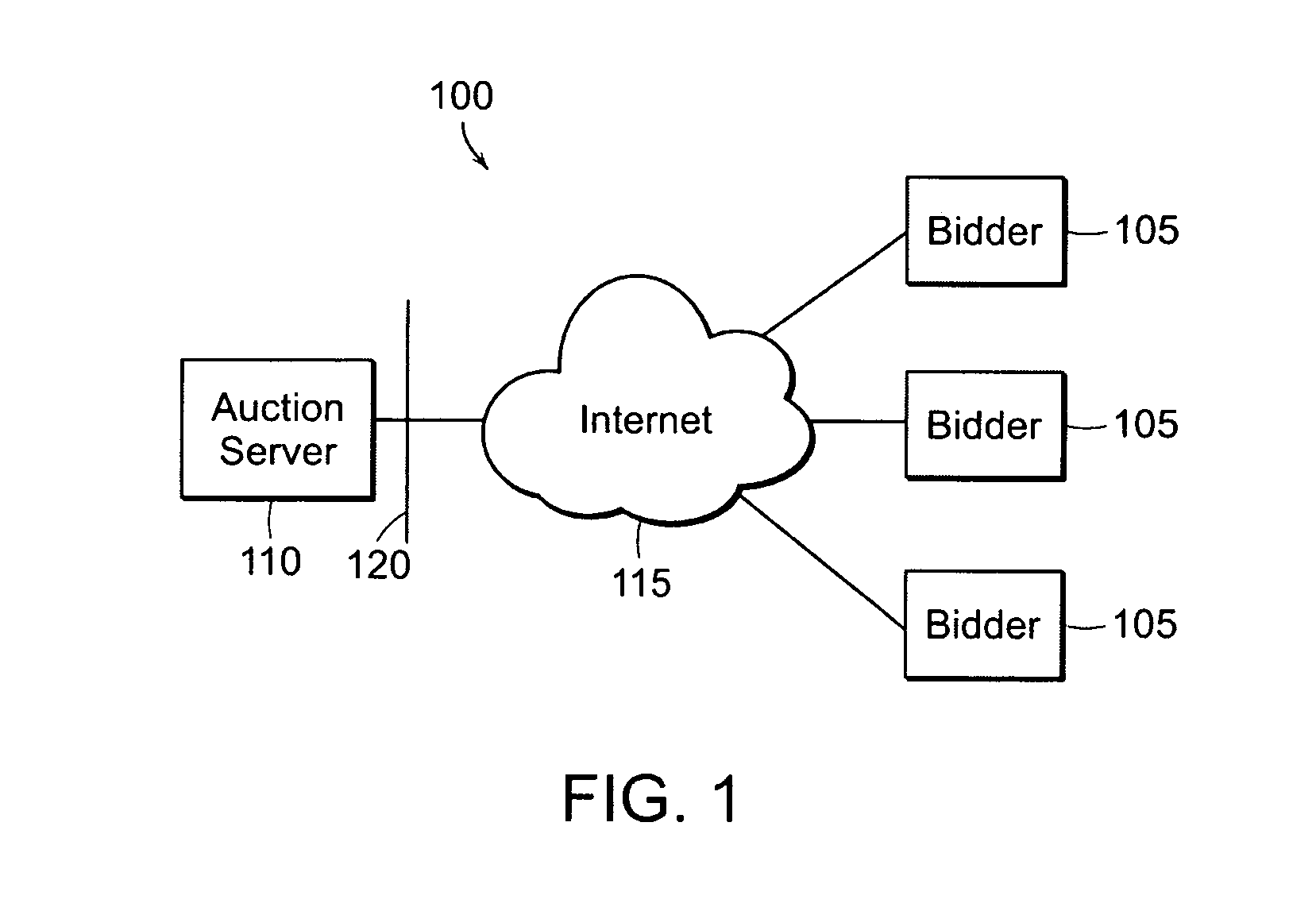

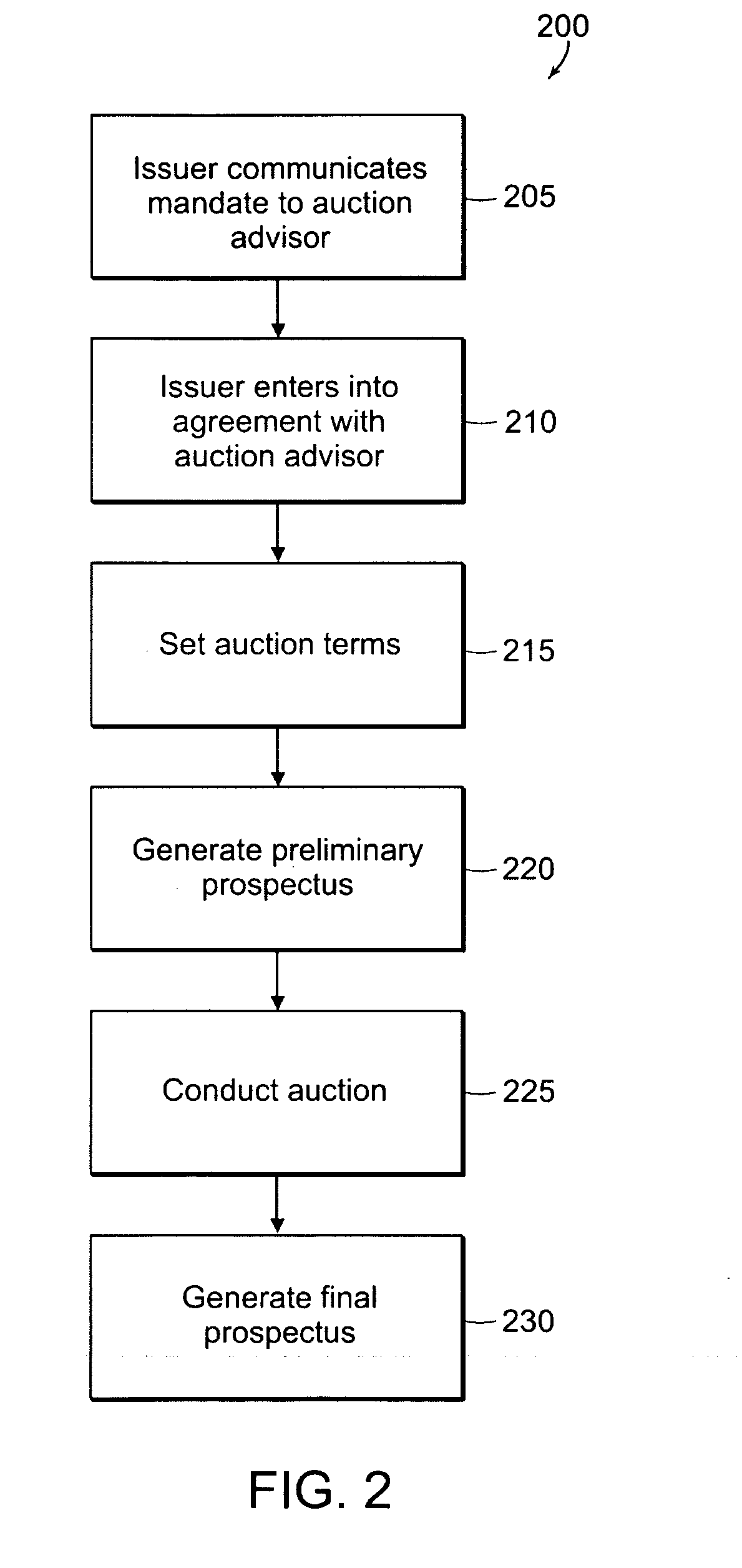

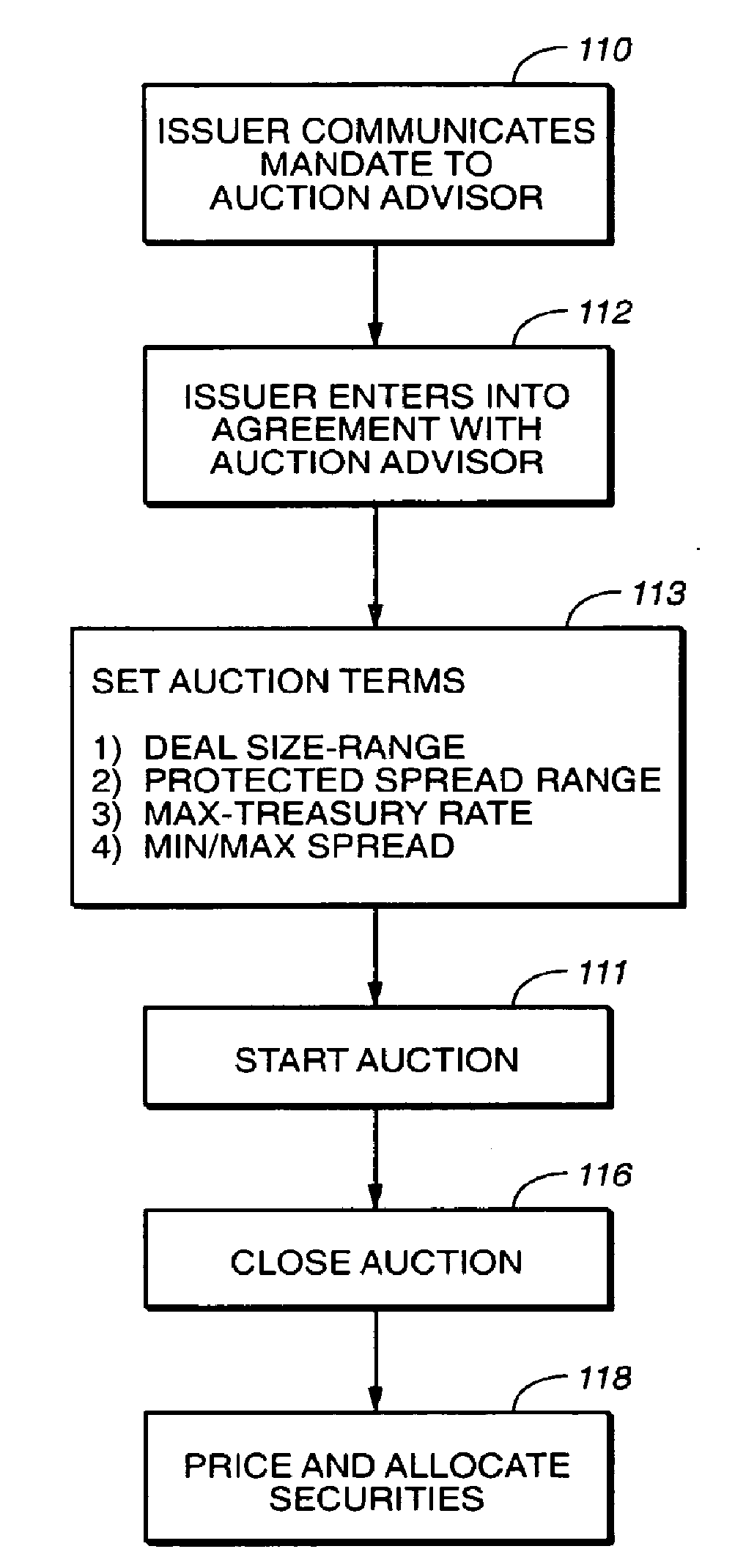

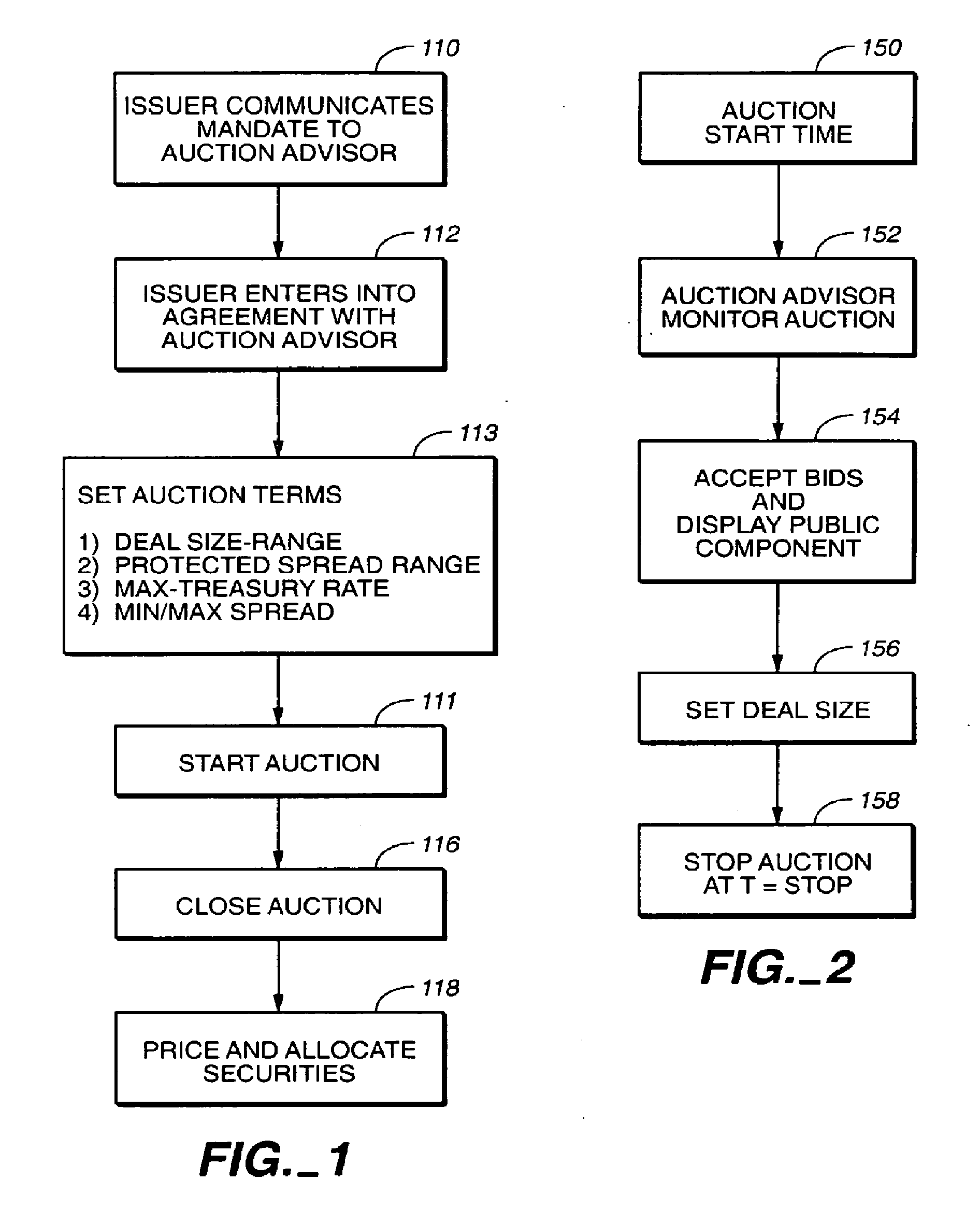

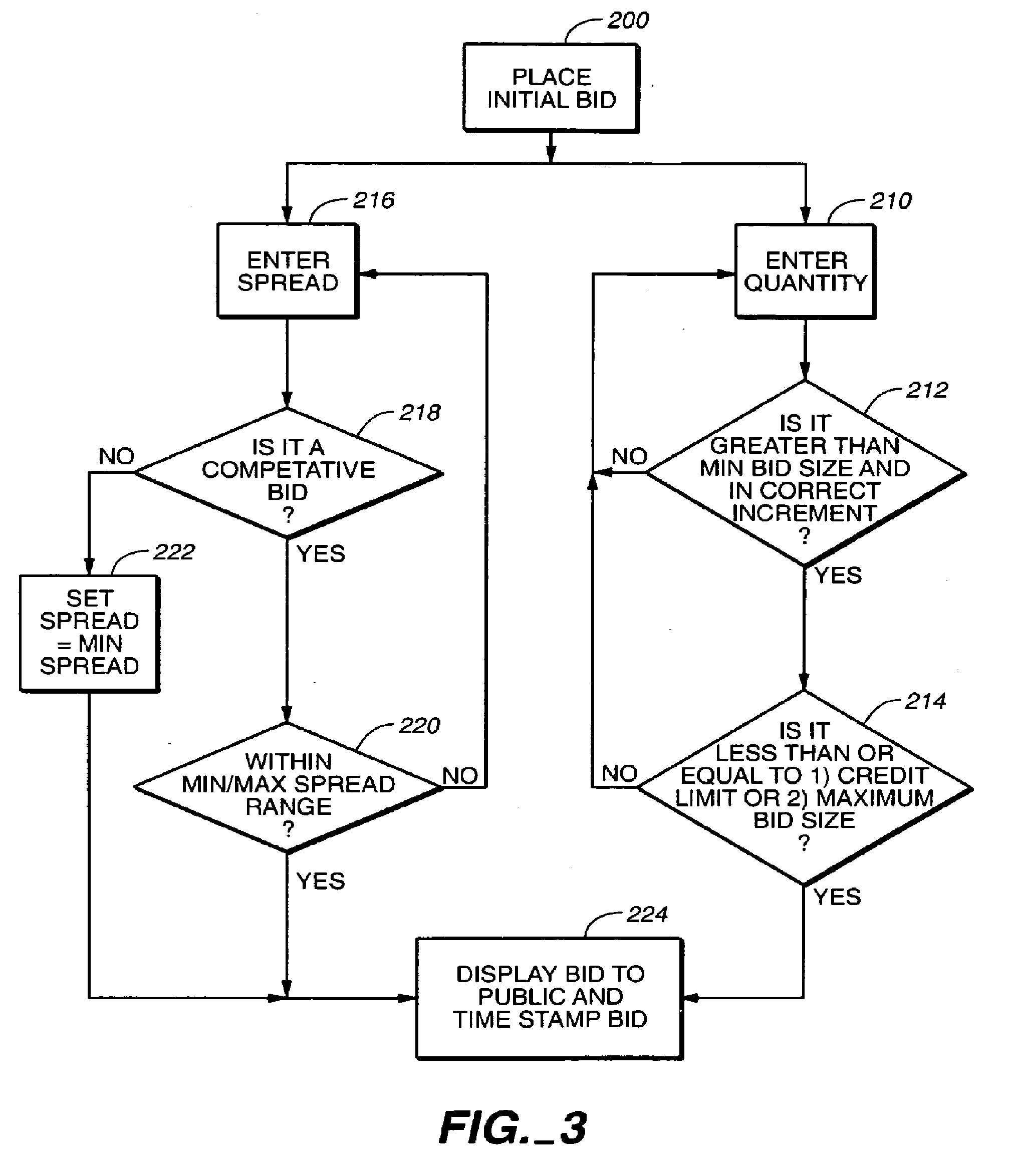

System and method for pricing and allocation of commodities or securities

InactiveUS7415436B1Transparent and low-costLow costAcutation objectsFinanceMarket placeComputer science

The present invention provides an economical, high performance, adaptable system and method (designated “the OpenBook system”) for conducting an auction of debt securities to institutional and individual investors on the Web. In the OpenBook system auction: (1) Bidders are rewarded for anonymously revealing their bids early; (2) All winners pay a single market-clearing price that sells out the securities; and (3) All participants can monitor the auction in real time. The OpenBook system thus creates a transparent and low-cost new issue market; offers all bidders equal access to securities; and gives both investors and issuers a “seat on the syndicate desk.”

Owner:W R HAMBRECHT CO

System and methods for pricing and allocation of commodities or securities

InactiveUS20070083457A1Transparent and low-costImprove performanceFinanceComputer scienceSecurity system

Systems and methods for conducting an auction of securities on the Web. The system and methods provide a bid mechanism whereby bidders are rewarded for priority of anonymously revealing their bids and provide an allocation of the securities which allows winning bidders to pay a single market-clearing price that sells out the securities. In addition, the systems and methods allow all participants to monitor the auction in real time.

Owner:W R HAMBRECHT CO

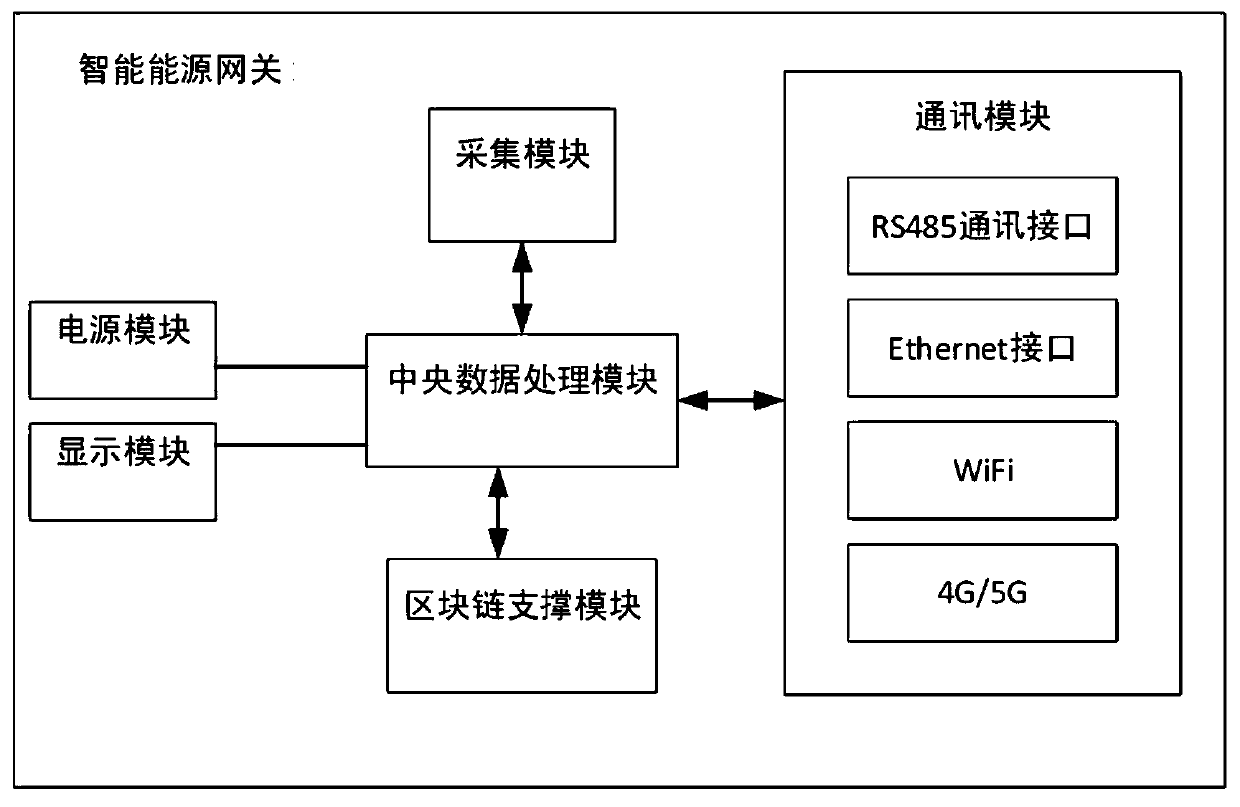

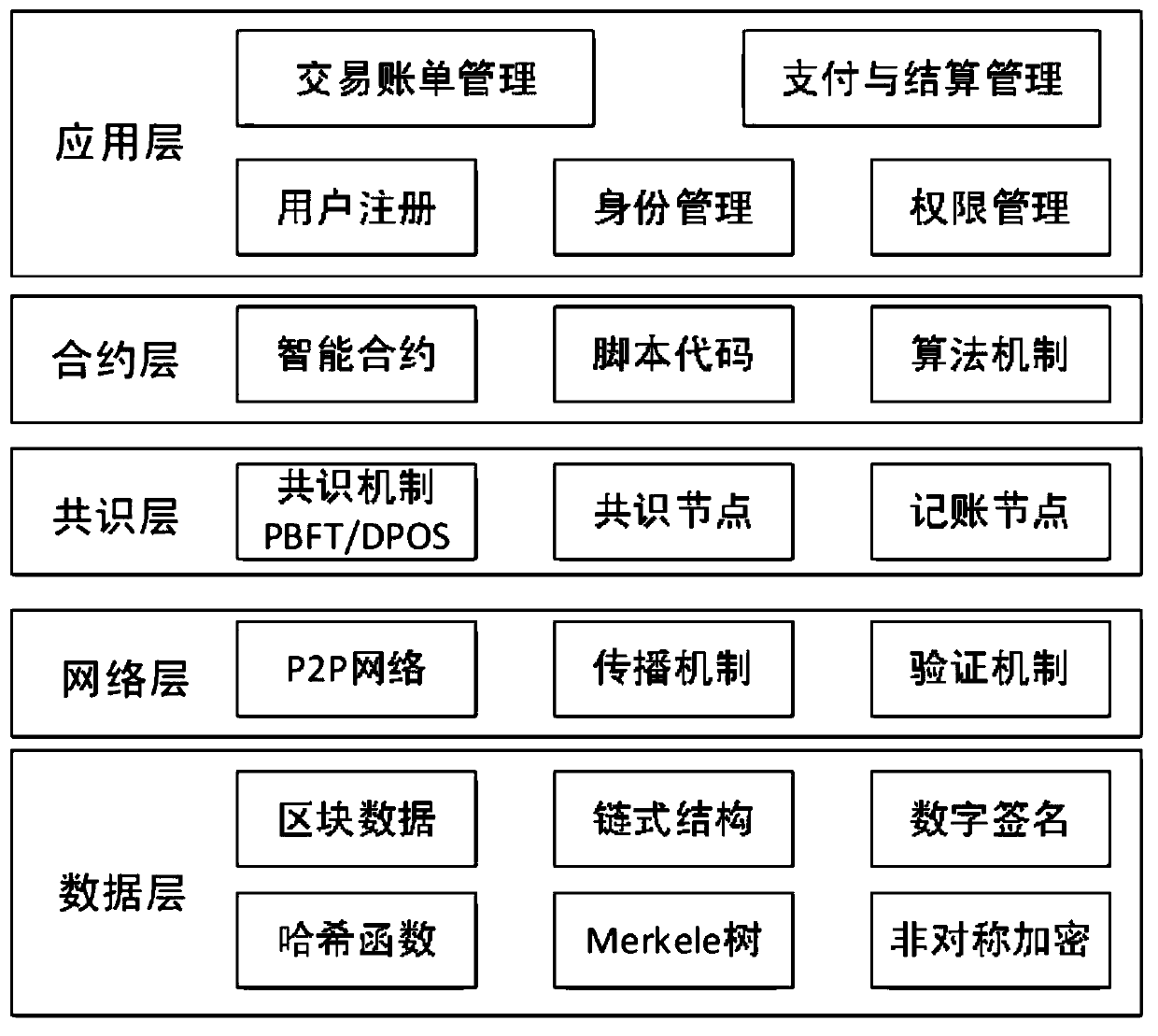

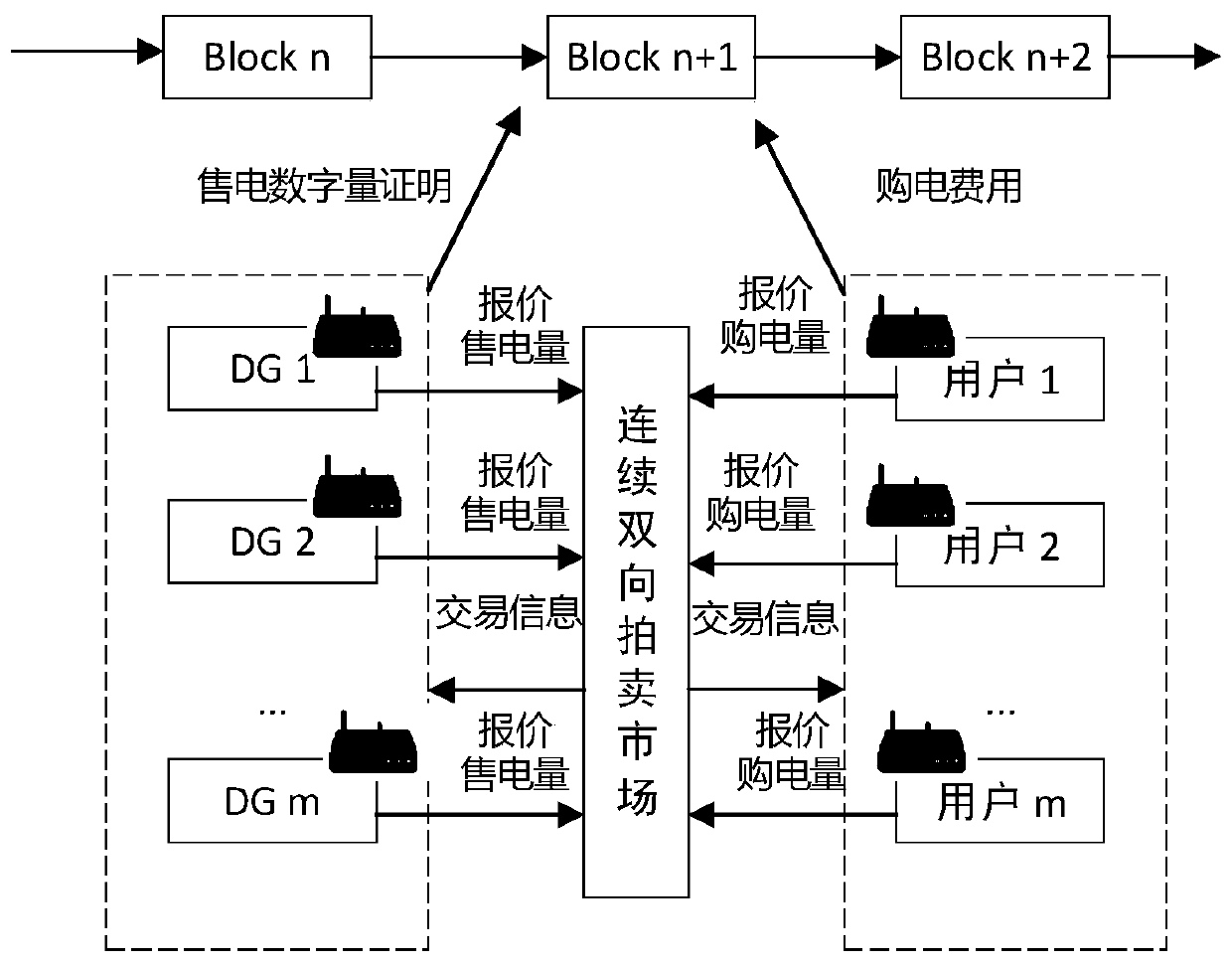

Intelligent energy gateway for user-side microgrid power transaction

PendingCN110415093AProtect interestsSafe and efficient consumption and utilizationBuying/selling/leasing transactionsMicrogridElectric power

The invention provides an intelligent energy gateway for user-side microgrid power transactions in combination with blockchain technology, and the functions of energy data uploading, power transactionexecution control, digital fund transfer and the like are realized through a user electricity purchasing and selling intelligent contract. When a transaction main body accesses the network, a transaction main body serves as a new information node of a network and uploads electric power production and consumption data and the like to a data block, a producer sends electricity selling information through a block chain network, an electric power user responds to a transaction request according to electricity demand quotation and triggers a state machine to start an intelligent contract, and buyers and sellers match transactions according to clearing prices obtained by two-way buying and selling; and finally, a blockchain consensus mechanism confirms the transaction information and writes thetransaction information into the energy blockchain. According to the invention, the transaction process is simplified, point-to-point power transaction with a high degree of automation is realized ata user side, benefit maximization of both production and consumption parties is ensured by combining a continuous bidirectional auction mechanism, and energy transaction between micro-grids is stimulated.

Owner:SHANGHAI ELECTRICAL APPLIANCES RES INSTGROUP +1

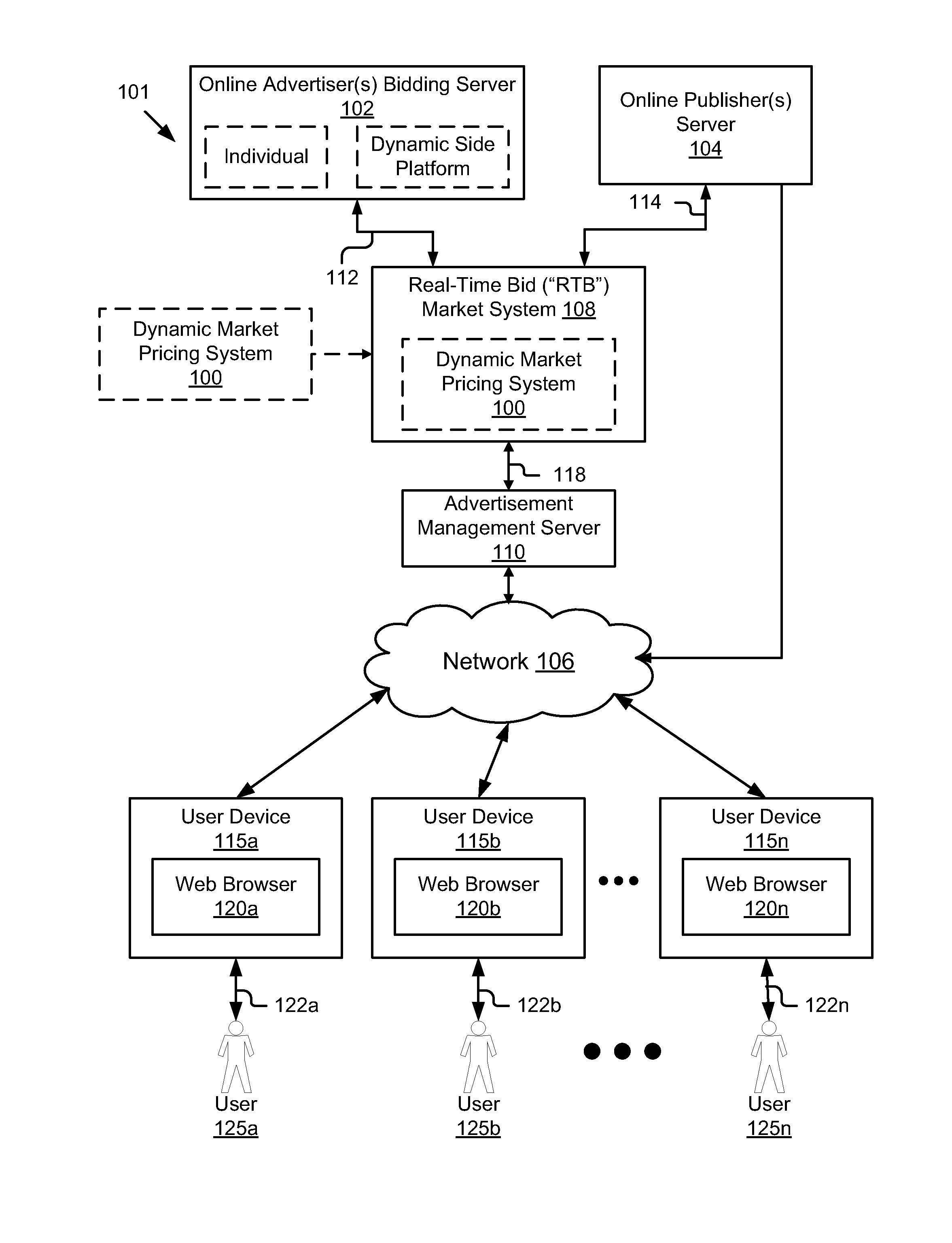

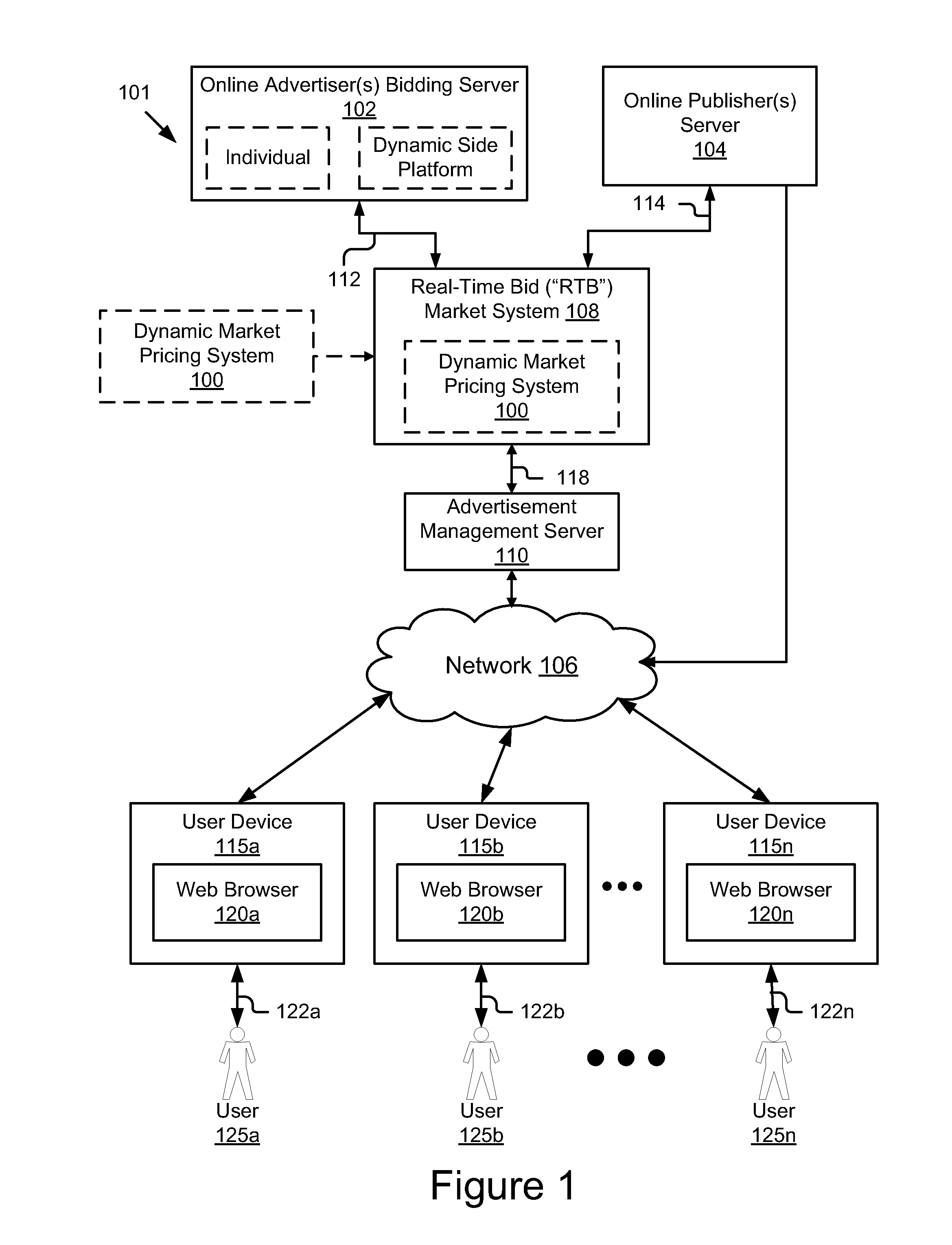

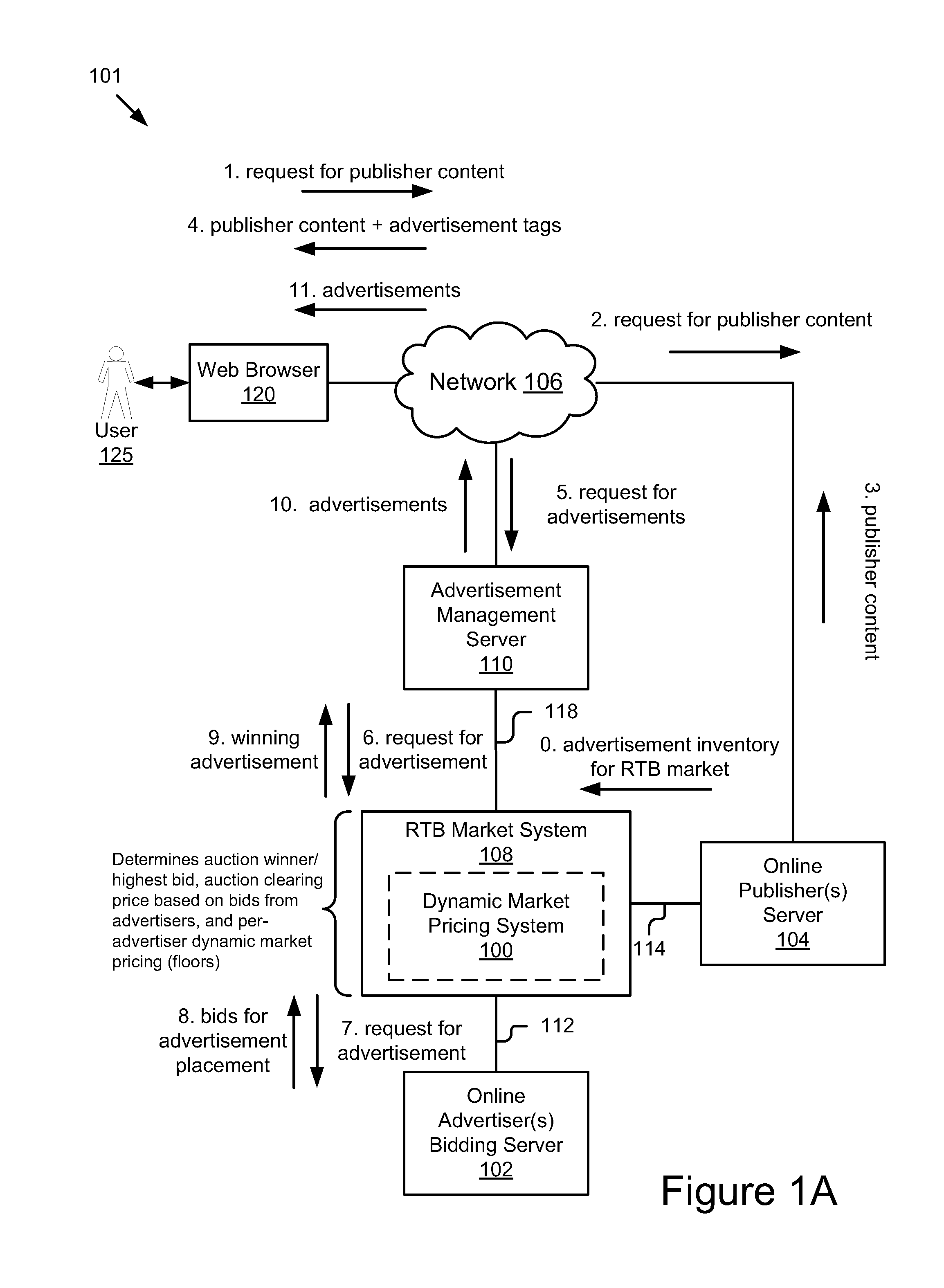

System and Methods for Generating Dynamic Market Pricing for Use in Real-Time Auctions

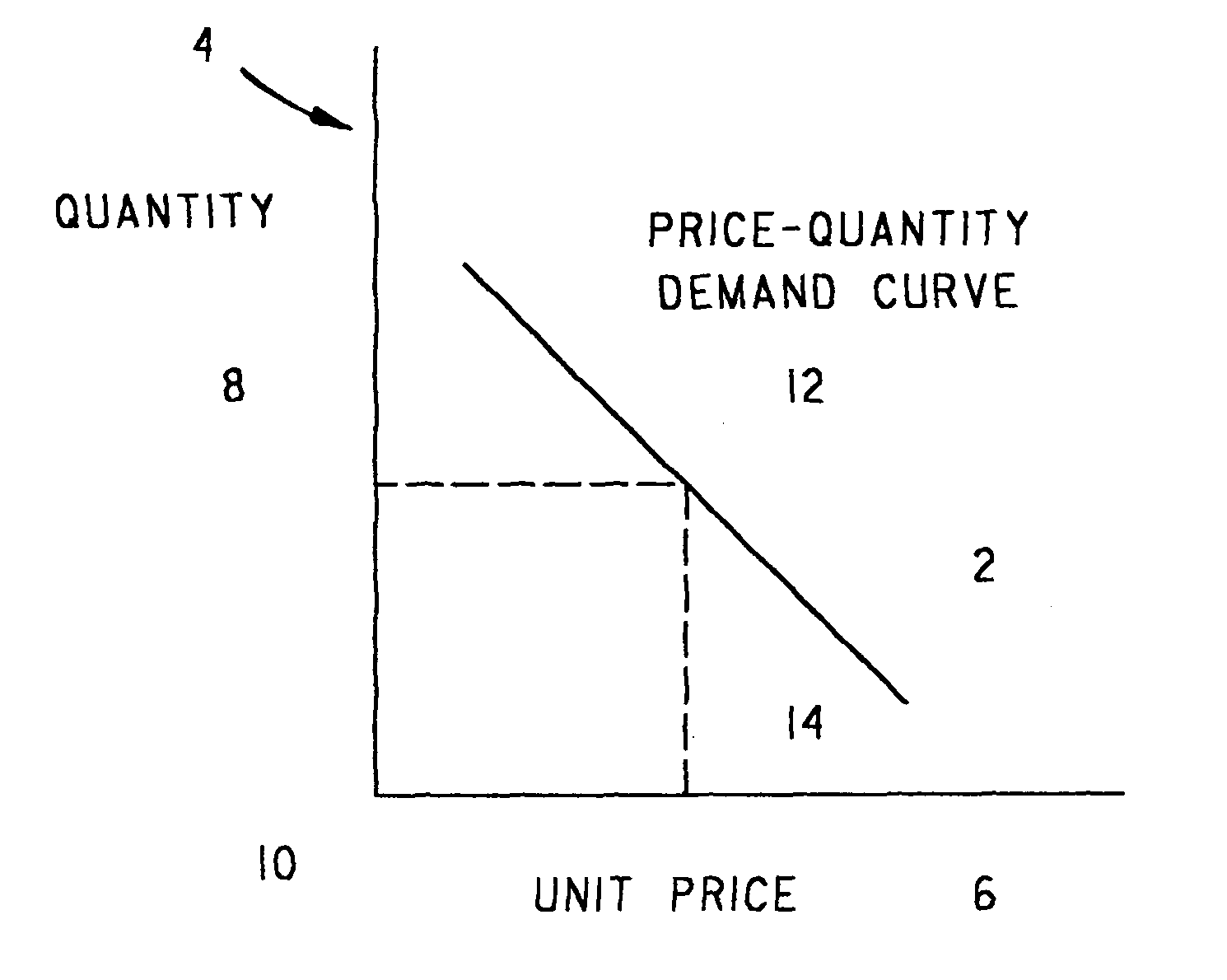

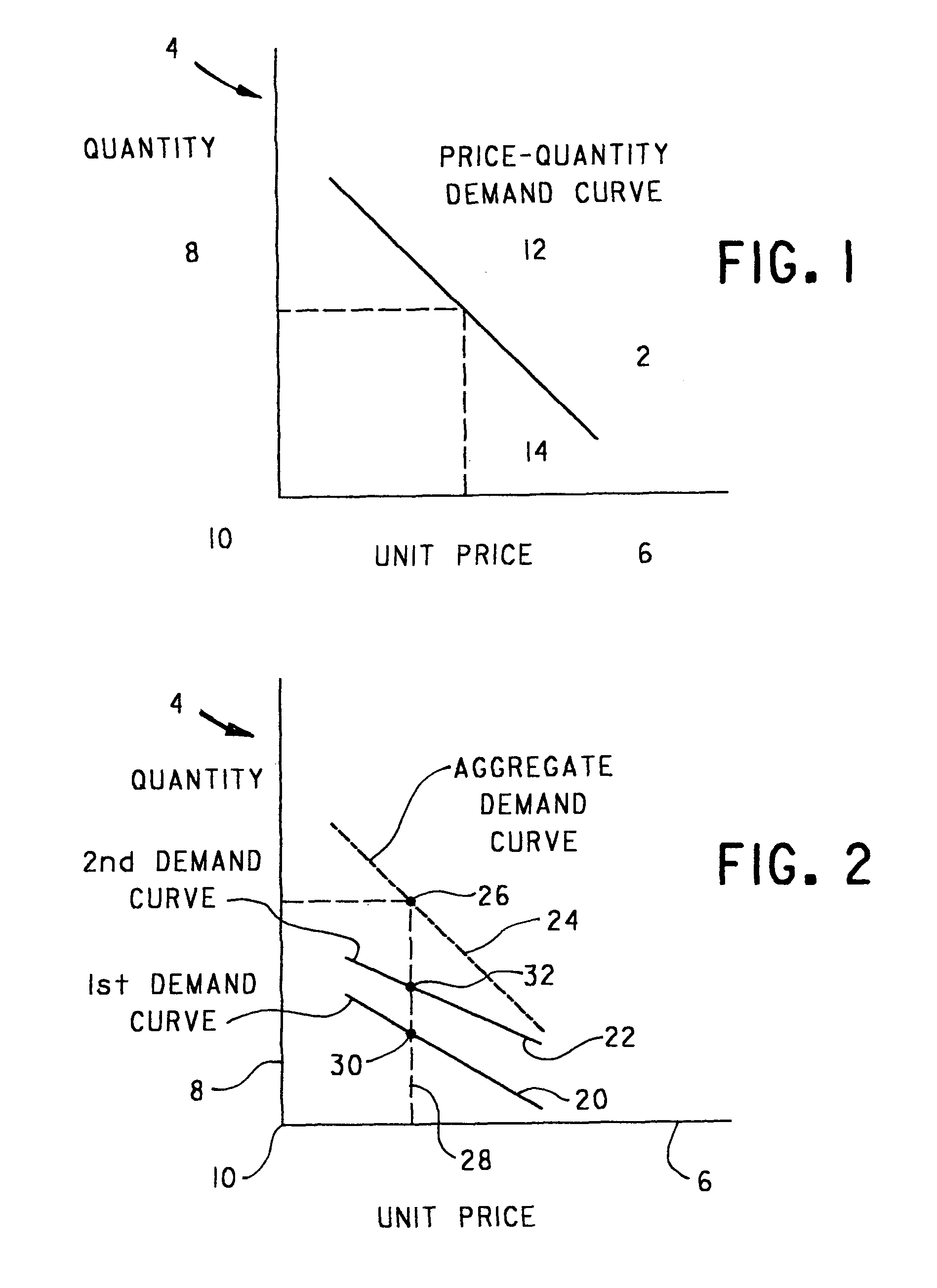

A system and methods for generating dynamic market pricing that is fair for both publishers and advertisers and the use of the pricing in real-time auctions. When a user views content over the internet, an online publisher provides content to the user with executable instructions, which notify an advertisement source that there is an impression for filling by an advertiser. The impression is submitted to a real-time bidding market for competing advertisers to bid to fill the impression with an advertisement. The system and methods generate dynamic pricing for the individual competing advertisers and use the dynamic pricing to compare advertiser bids to determine a highest or winning bid and a clearing price associated with the highest or winning bid.

Owner:OPENX TECH

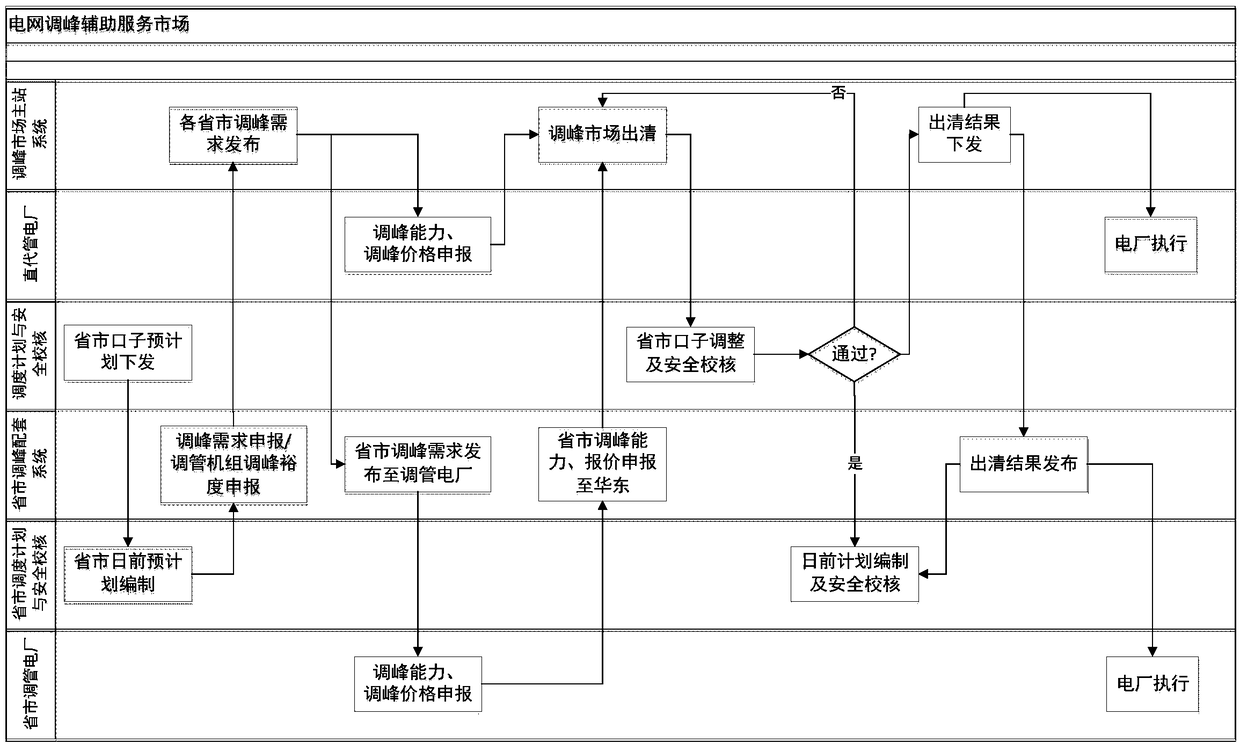

A method and system for trade inter-provincial peak shaving auxiliary service

InactiveCN109508853ASpeed up the flowImprove peak shaving performanceMarket predictionsForecastingNew energyPower grid

The invention discloses an inter-provincial peak shaving auxiliary service transaction method and system. The method comprises the following steps: receiving provincial and municipal tie line outlet pre-power generation plan and preparing provincial and municipal pre-power generation plan, including determining the peak shaving demand of each provincial and municipal next day or the peak shaving margin of each provincial and municipal regulating unit; declaring the peak-shaving demand of each province or municipality or the peak-shaving margin of each provincial or municipal pipe-regulating unit on the next day; Releasing the demand of each province and city for peak shaving on the next day; Receiving the peak-shaving capacity and peak-shaving price declared by the power plant with peak-shaving margin on the next day and clearing the peak-shaving market according to the peak-shaving demand of each province and city on the next day; Purchasing peak shaving auxiliary service provincial and municipal clearing power, sellling peak shaving auxiliary service management unit clearing power for peak shaving cost allocation and settlement according to the clearing price in each period. Theinvention encourages power generation enterprises to actively participate in peak shaving auxiliary service by economic means, improves the peak shaving capacity of the unit, releases peak shaving resources, alleviates the peak shaving difficulty of the power network, and improves the new energy consumption capacity among provinces.

Owner:NARI TECH CO LTD +4

Internet-Based System for Auctioning Securities

A method of auctioning exchange traded assets is described. Before commencing the auction bidding, the seller establishes a maximum asset amount representing a greatest amount of the exchange traded assets to be auctioned, and a minimum asset price representing a minimum acceptable bid amount for a given amount of the exchange traded assets. During the bidding, bids are received for the assets, with each bid including a bid price and a corresponding bid amount of assets. After the bidding, a market demand is determined that represents the total of all the bid amounts for the bids. If the market demand is greater than or equal to the maximum asset amount, a clearing price is established that allocates the maximum asset amount of the assets according to the bids at a final price between and including the clearing price and the minimum asset price. Otherwise, if the market demand is less than the maximum asset amount, the market demand amount of the assets according to the bids at a final price equal to the minimum asset price.

Owner:W R HAMBRECHT CO

Internet-based system for auctioning securities

InactiveUS20060282367A1Reduce the possibilityImprove performanceFinanceComputer scienceInternet based

Methods and apparatus for auctioning securities. The methods and apparatus receive one or more backstop bids for the securities from one or more backstop bidders and implement a real-time auction of securities over the Internet. The methods and apparatus determine a clearing price for the auction, the clearing price being determined such that all of the securities are distributed and allocate at least a portion of the securities to the one or more backstop bidders if the clearing price is less than the backstop bids.

Owner:WR HAMBRECHT + CO

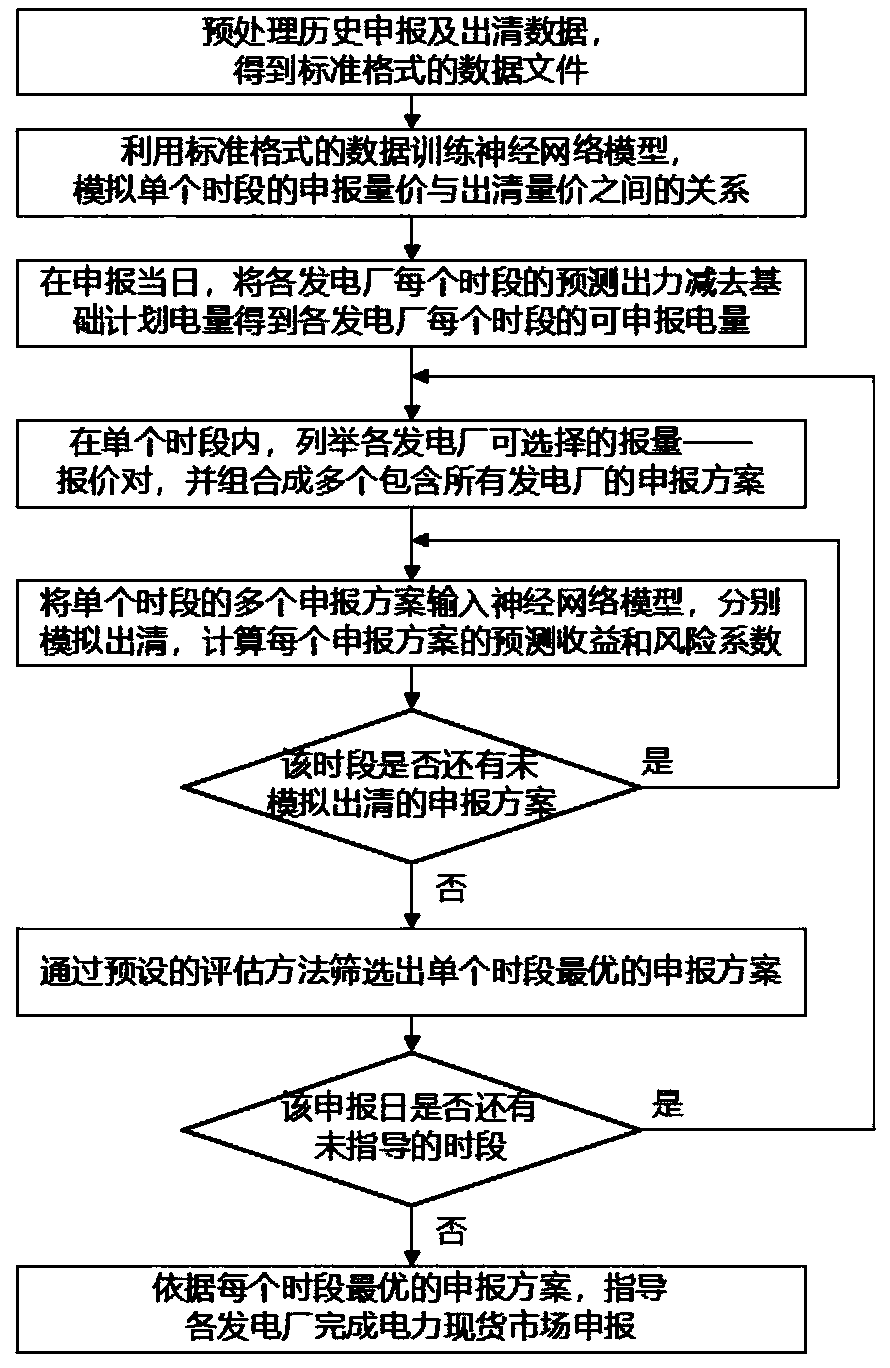

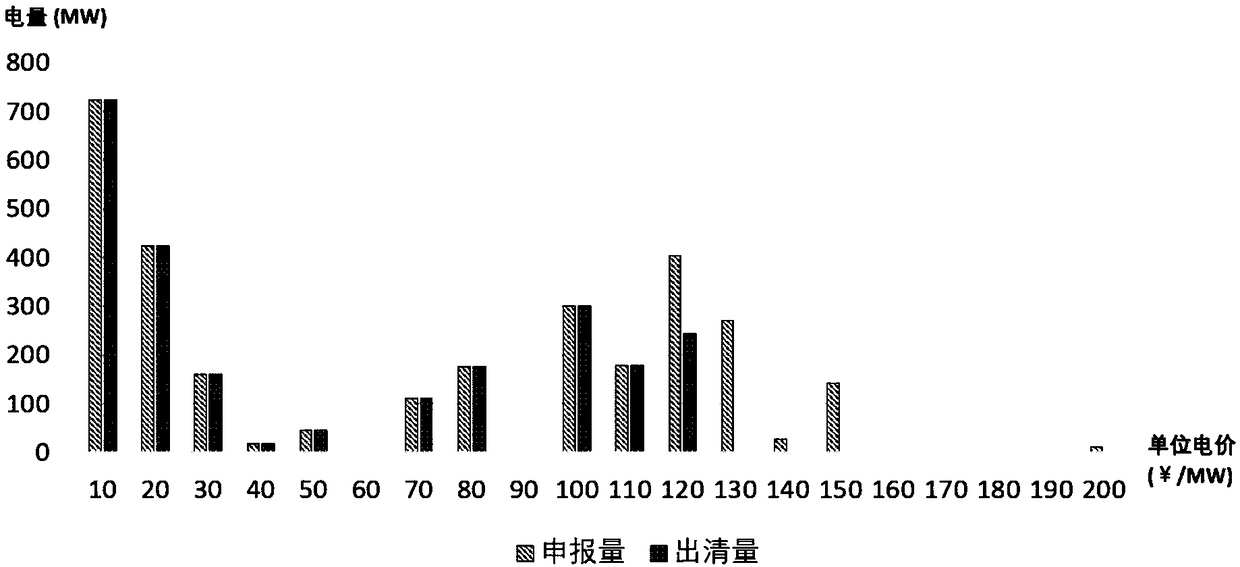

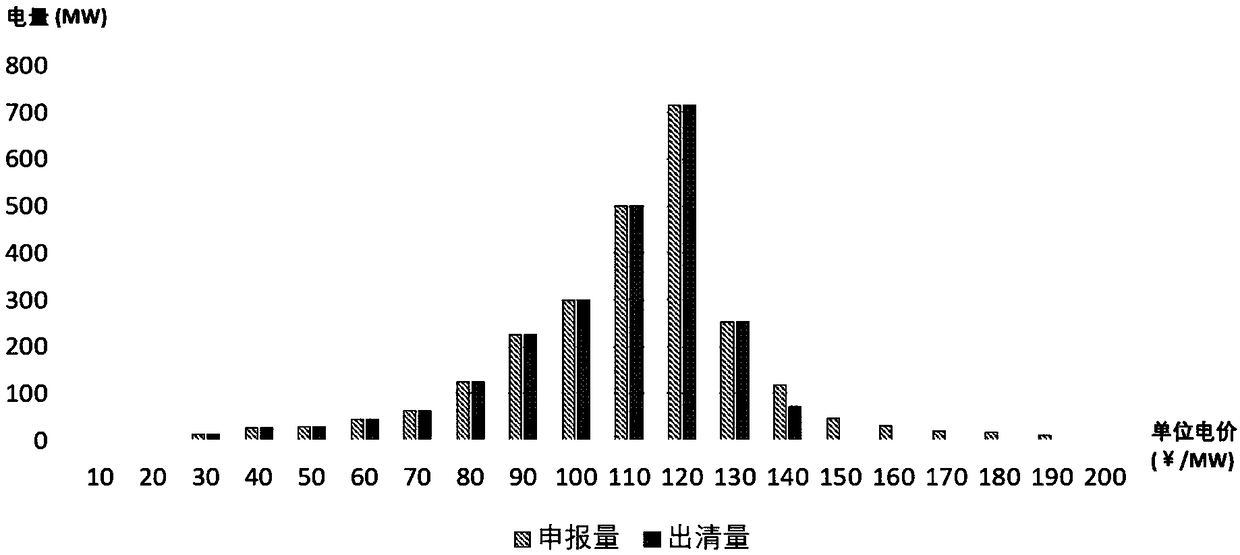

Electric power spot market auxiliary transaction method based on neural network

InactiveCN108921601AEasy constructionImprove developmentMarket predictionsResourcesPower stationNerve network

Owner:ZHEJIANG UNIV

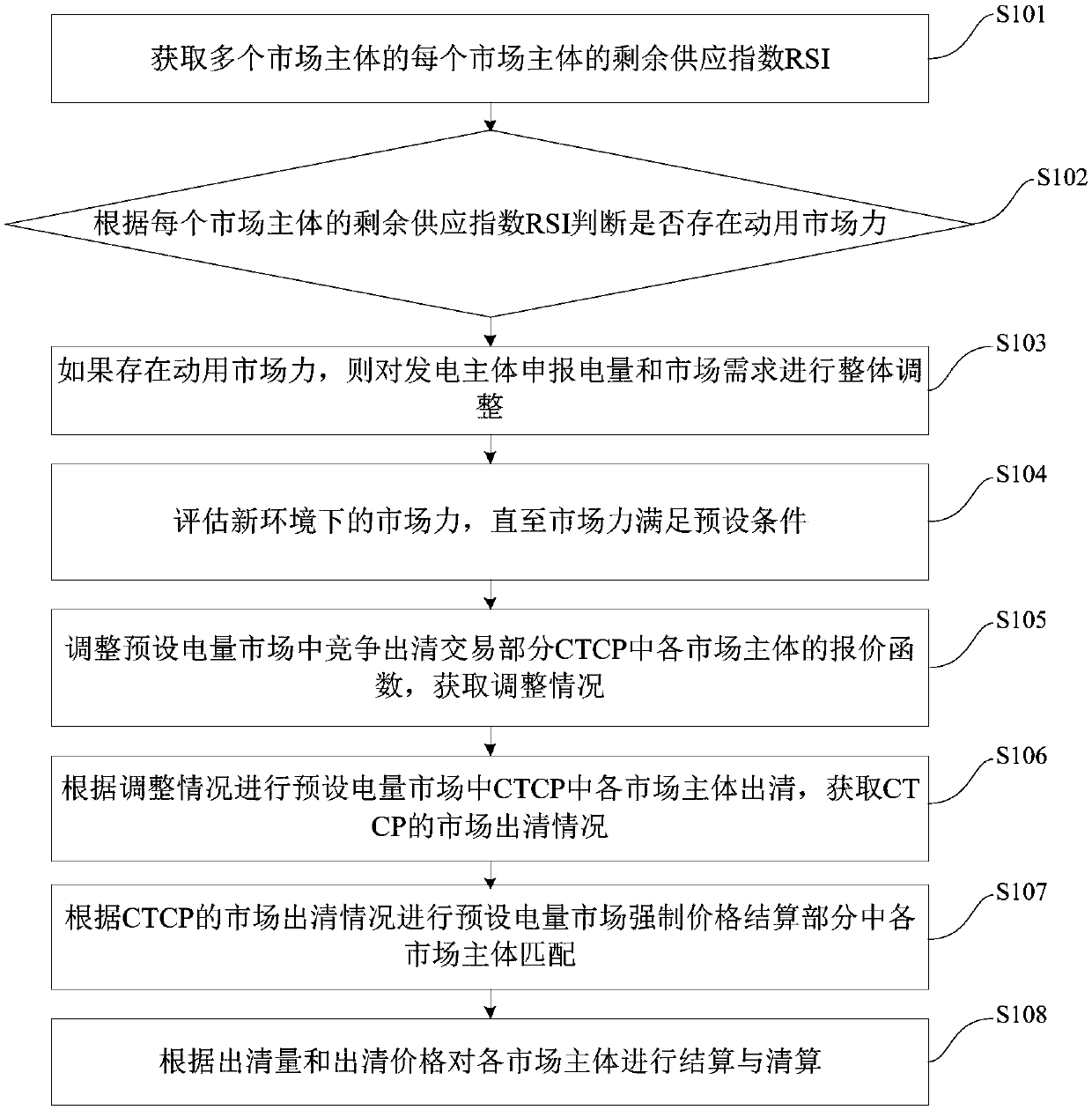

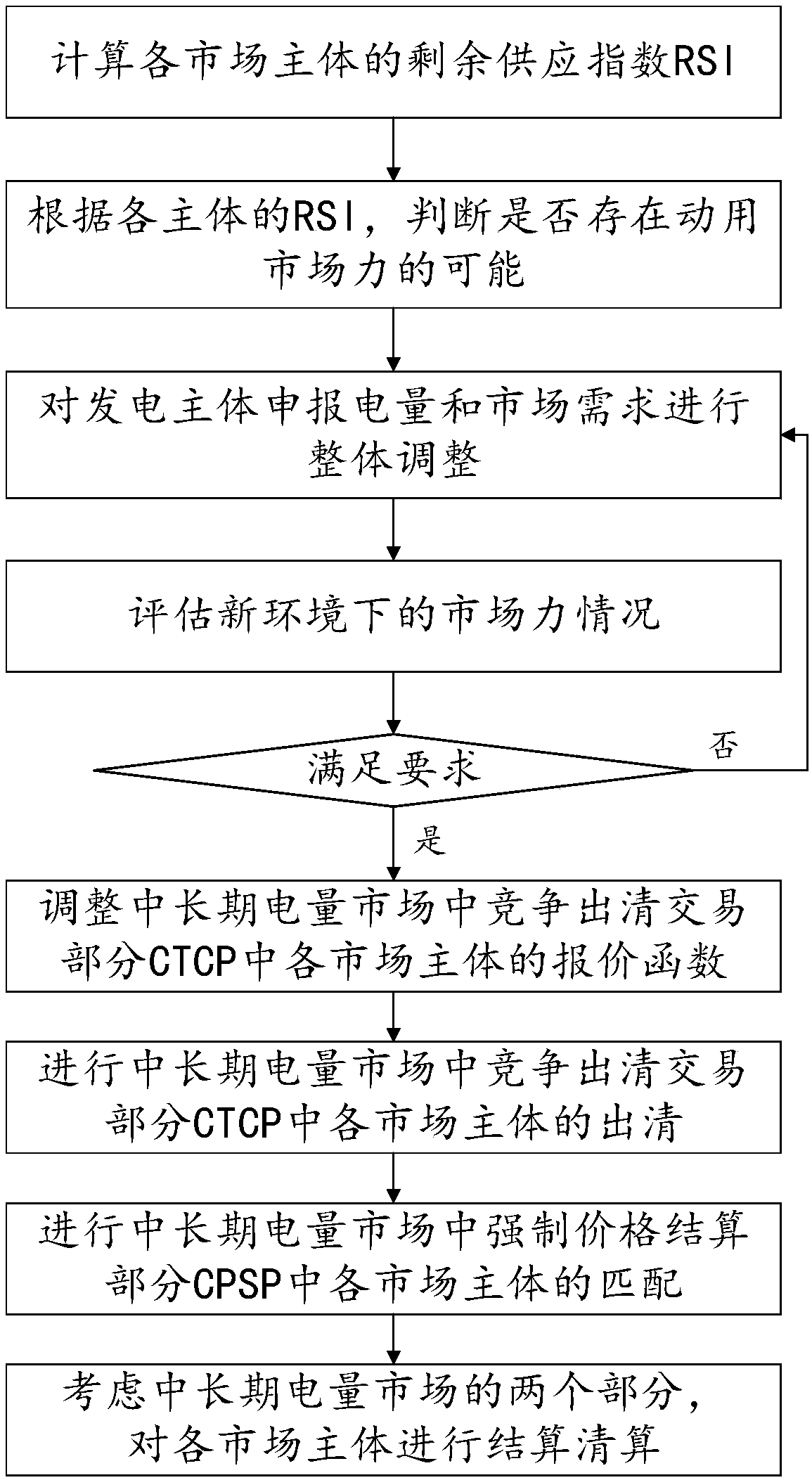

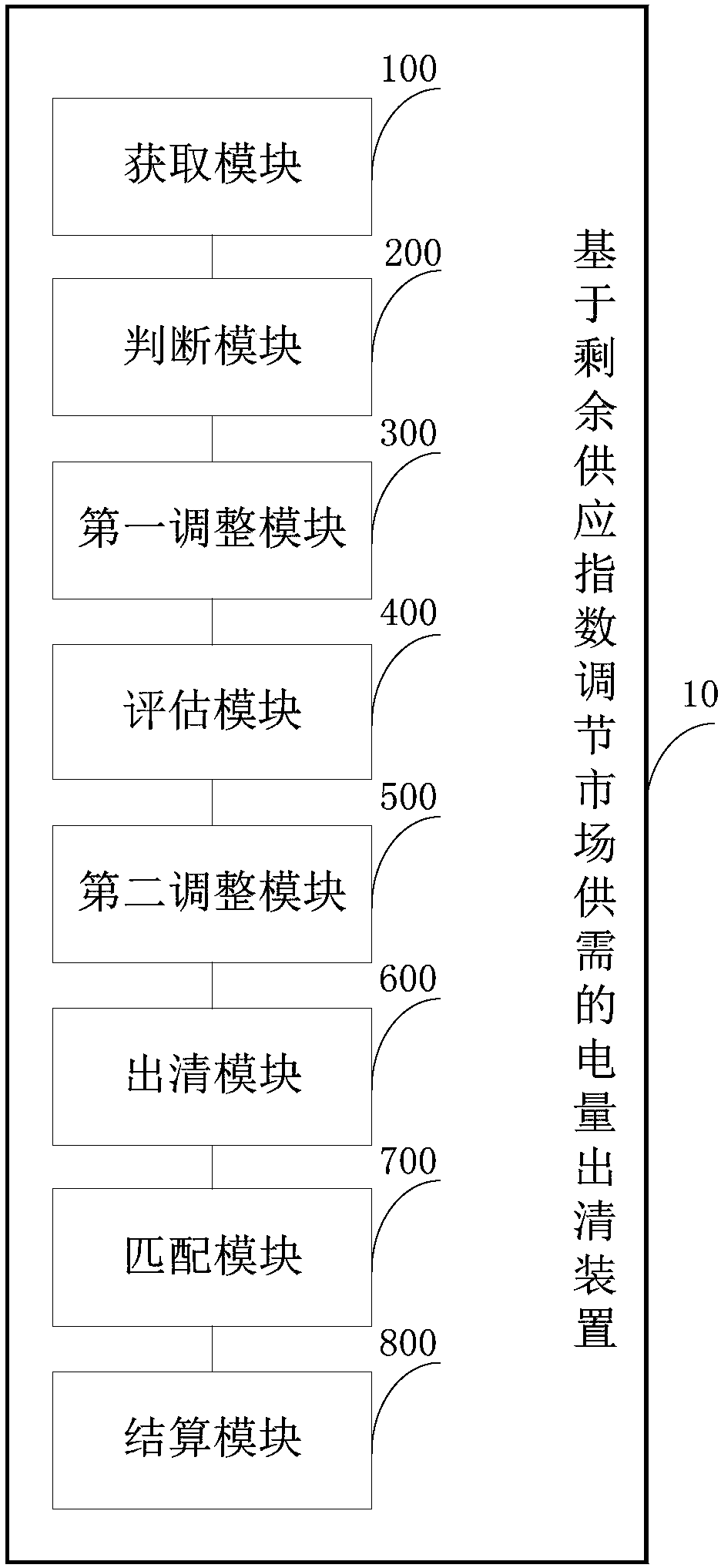

Electricity clearing method and apparatus for adjusting market supply and demand based on residual supply index

InactiveCN108022178AFully clearedBuying/selling/leasing transactionsInformation technology support systemPotential marketMarket needs

The invention discloses an electricity clearing method and apparatus for adjusting the market supply and demand based on a residual supply index. The method comprises: residual supply indexes of a plurality of market subjects are obtained; if market power is employed, overall adjustment is carried out on power declared by power generation subjects and market needs of the power generation subjects;bidding functions of all market subjects in a competition clearing transaction part in a preset electricity market are adjusted and adjustment information is obtained; clearing of all market subjectsin the preset electricity market is carried out based on the adjustment information and market clearing information of a CTCP is obtained; on the basis of the market clearing information of the CTCP,matching of all market subjects in a forced price settlement part of the preset electricity market is calculated; and according to a clearing amount and a clearing price, settlement and clearing arecarried out on all market subjects. Therefore, the bidding electricity of the power generation subjects with the potential market power can be divided into two parts: a competition participation clearing transaction part and a forced price settlement part; and while the market supply and demand ratio is kept to be unchanged, full-competition market clearing is realized.

Owner:TSINGHUA UNIV

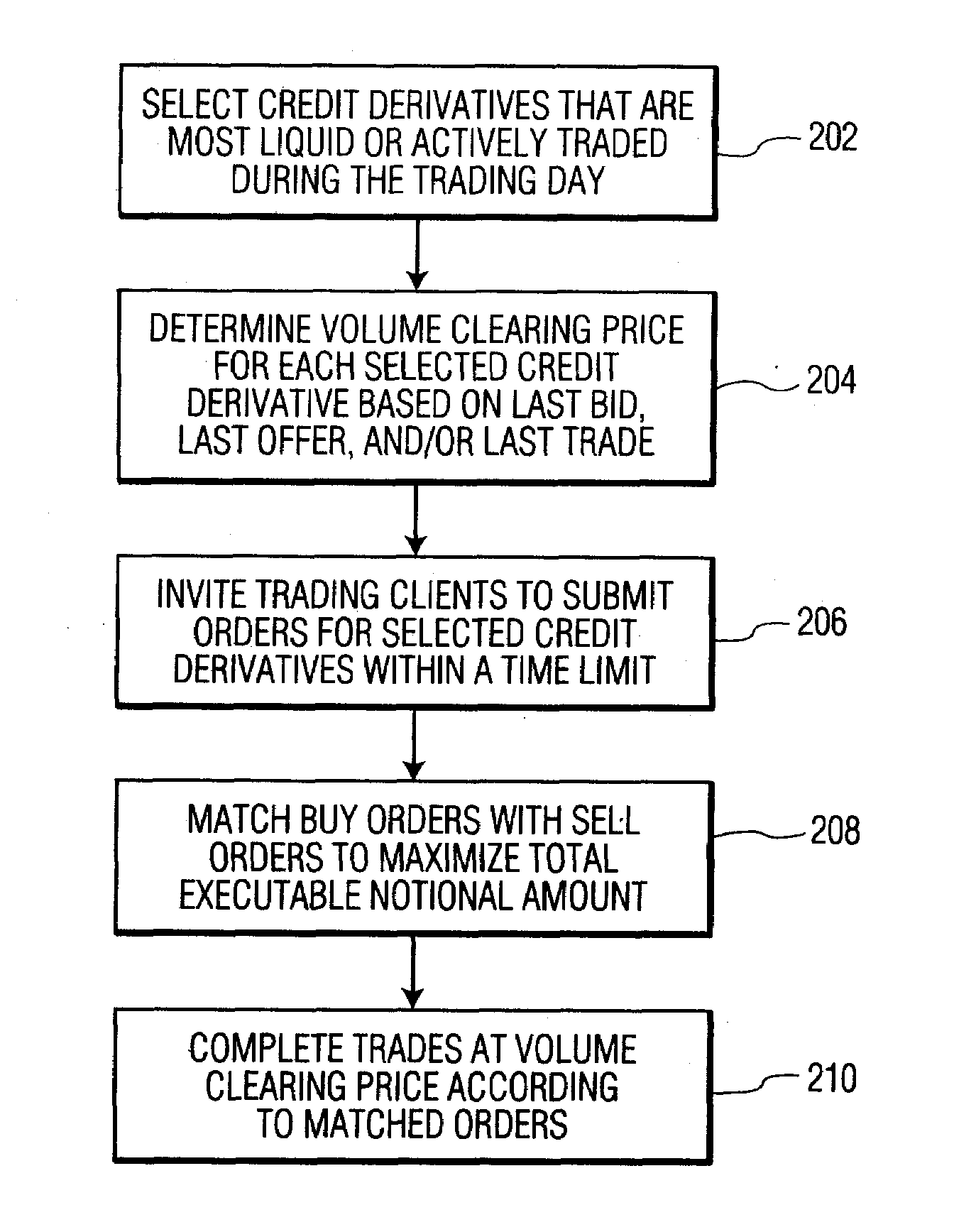

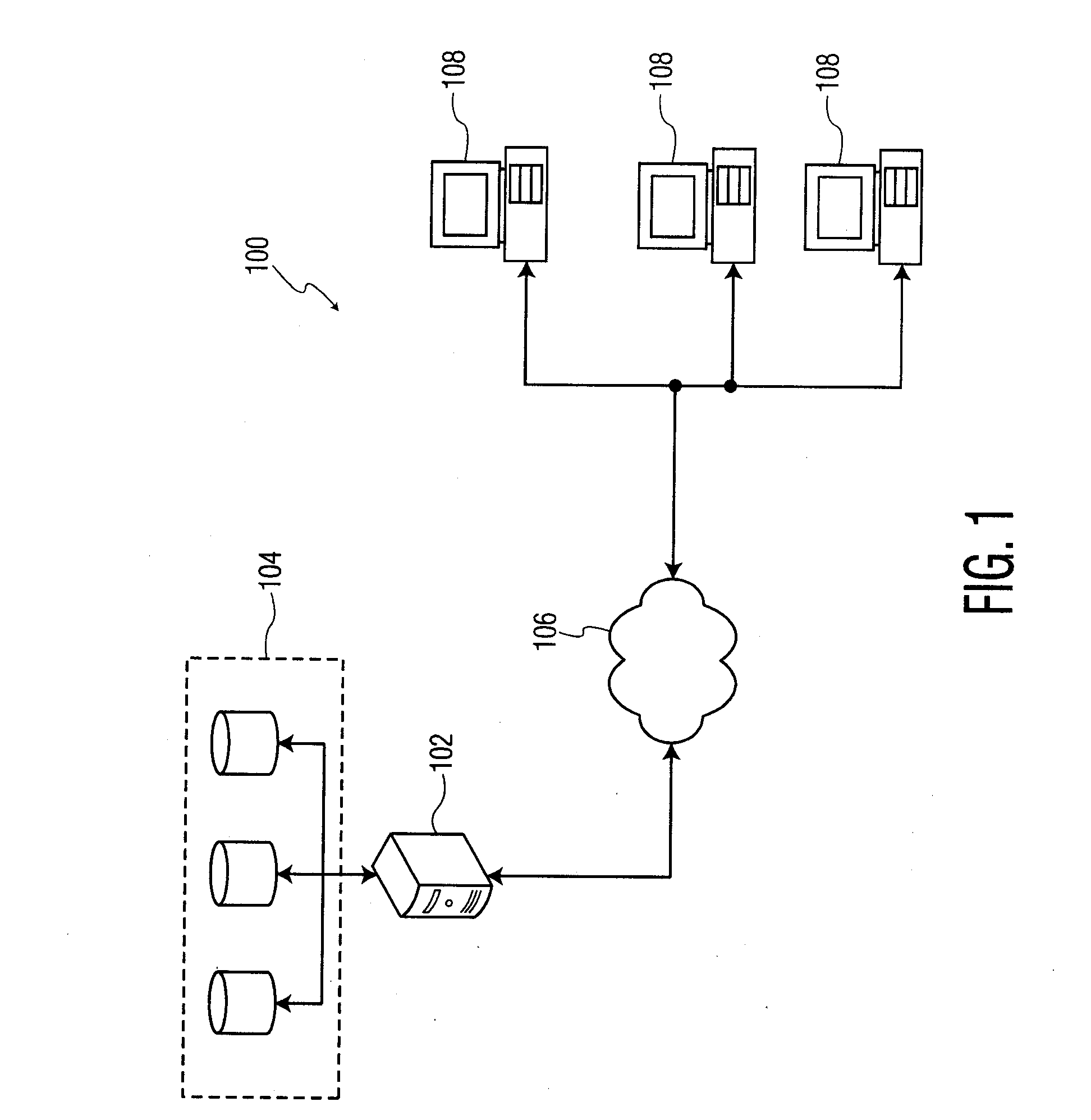

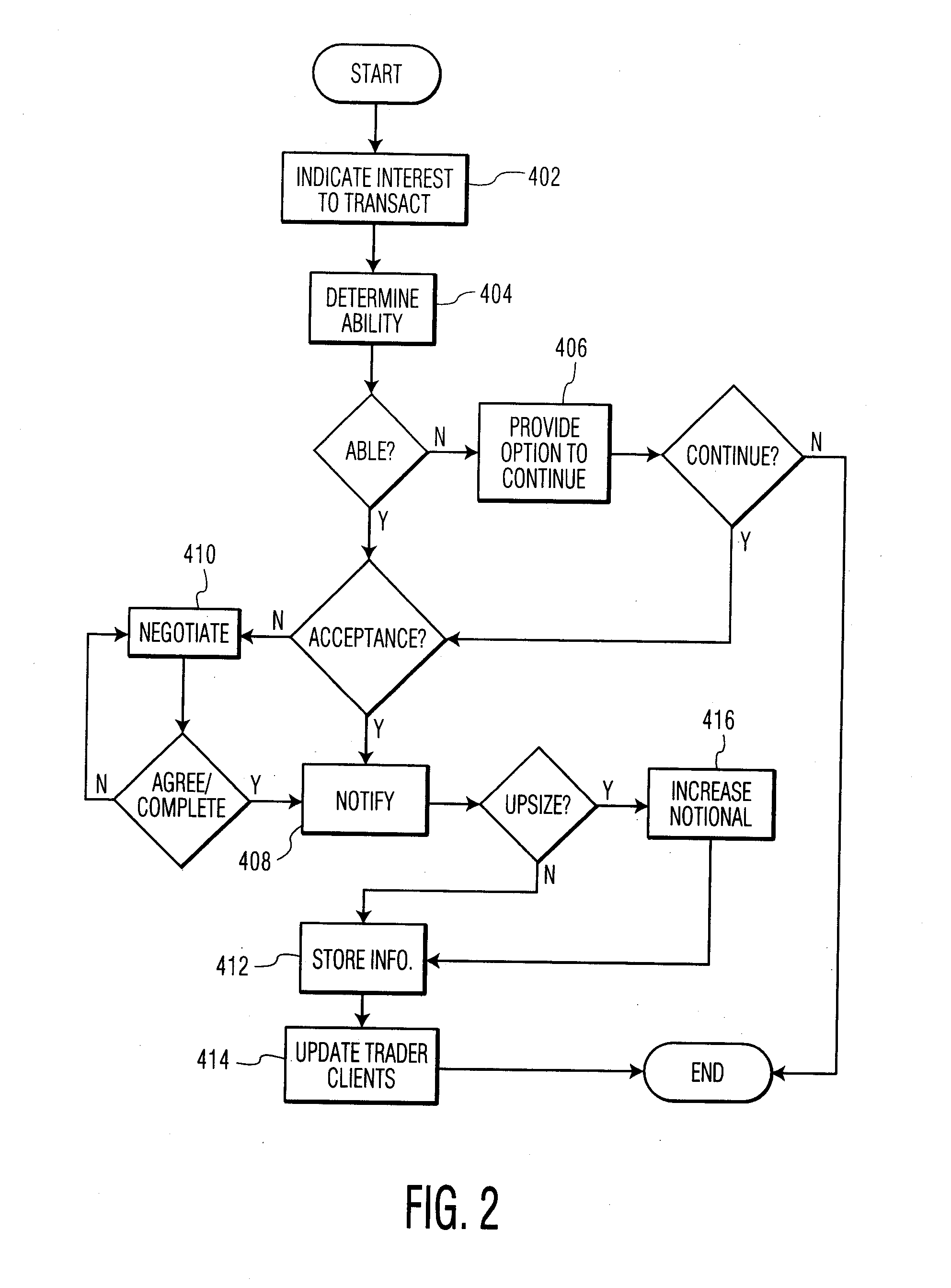

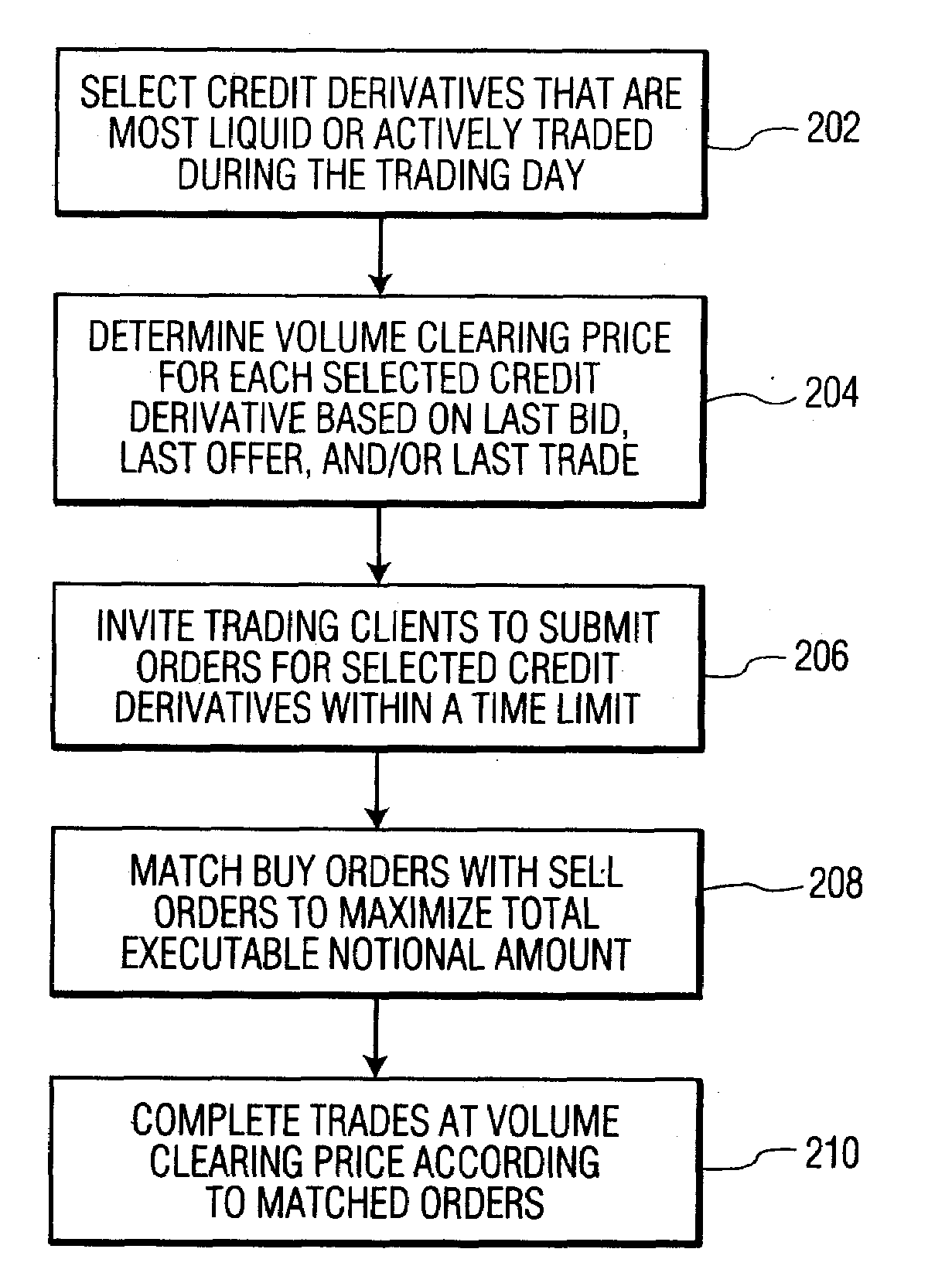

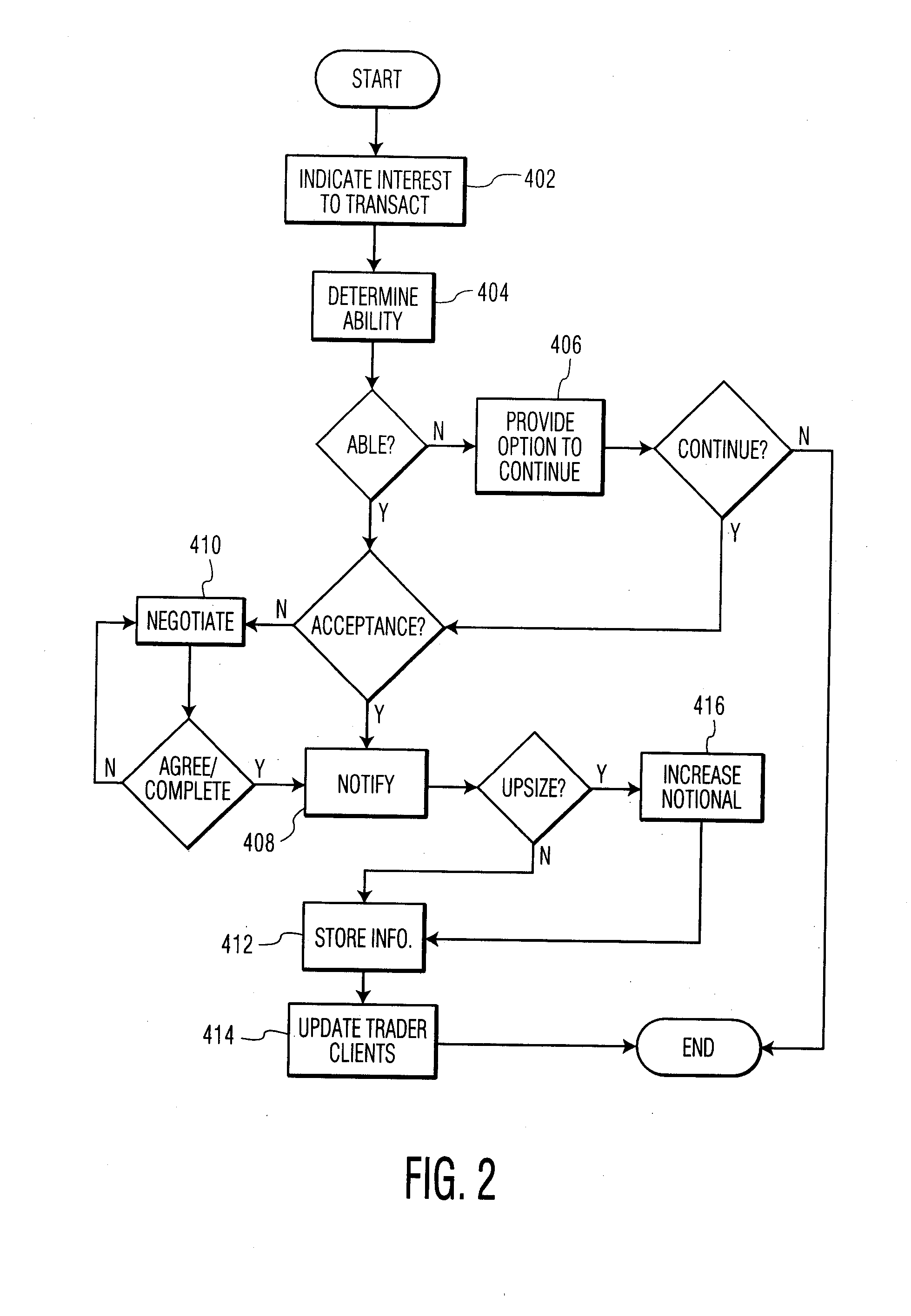

Systems and Methods for Limit Order Volume Clearing in Online Trading of Credit Derivatives

Systems and methods for limit order volume clearing in online trading of credit derivatives are disclosed. In one embodiment, a method for limit order volume clearing may comprise: selecting a set of credit derivatives based on dealer interest and market activities; inviting trading clients to submit, within a time limit, buy orders and sell orders for the selected credit derivatives; determining an auction price for each of the selected credit derivatives, such that a total notional amount of trades that can be executed at the auction price is the largest possible and a total notional amount of unfilled orders is the smallest possible: executing a first subset of the buy orders and the sell orders that can be completed at the determined auction price; and launching a volume clearing session, with a volume clearing price level set to the determined auction price, for a second subset of the buy orders and the sell orders that have not been filled.

Owner:CREDITEX GROUP

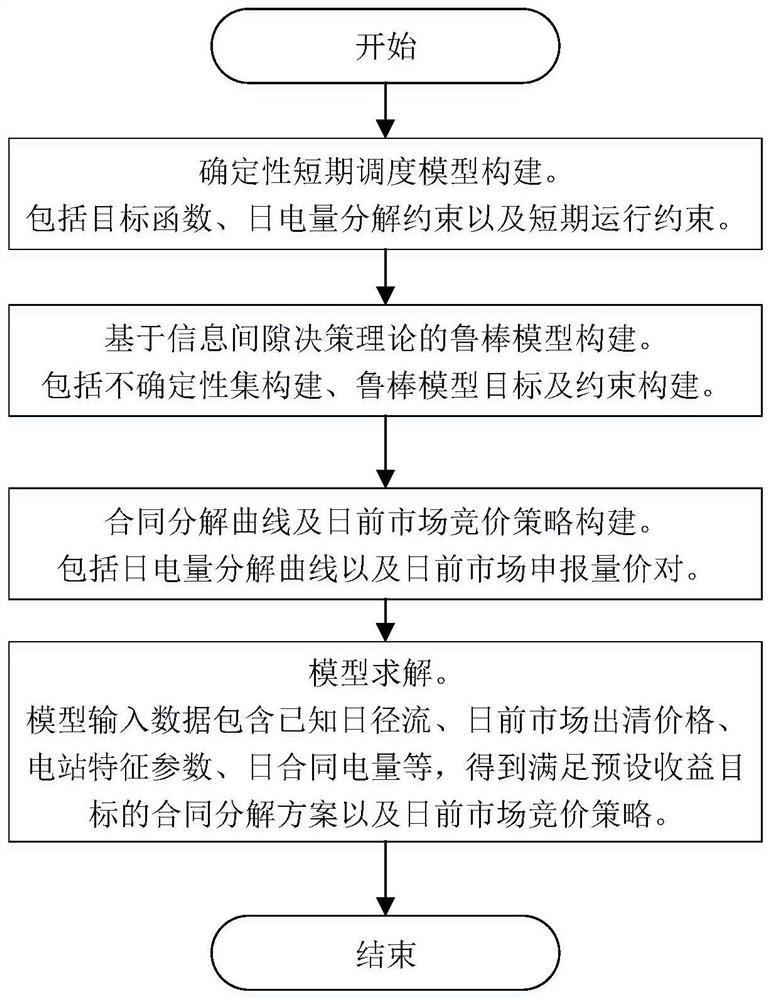

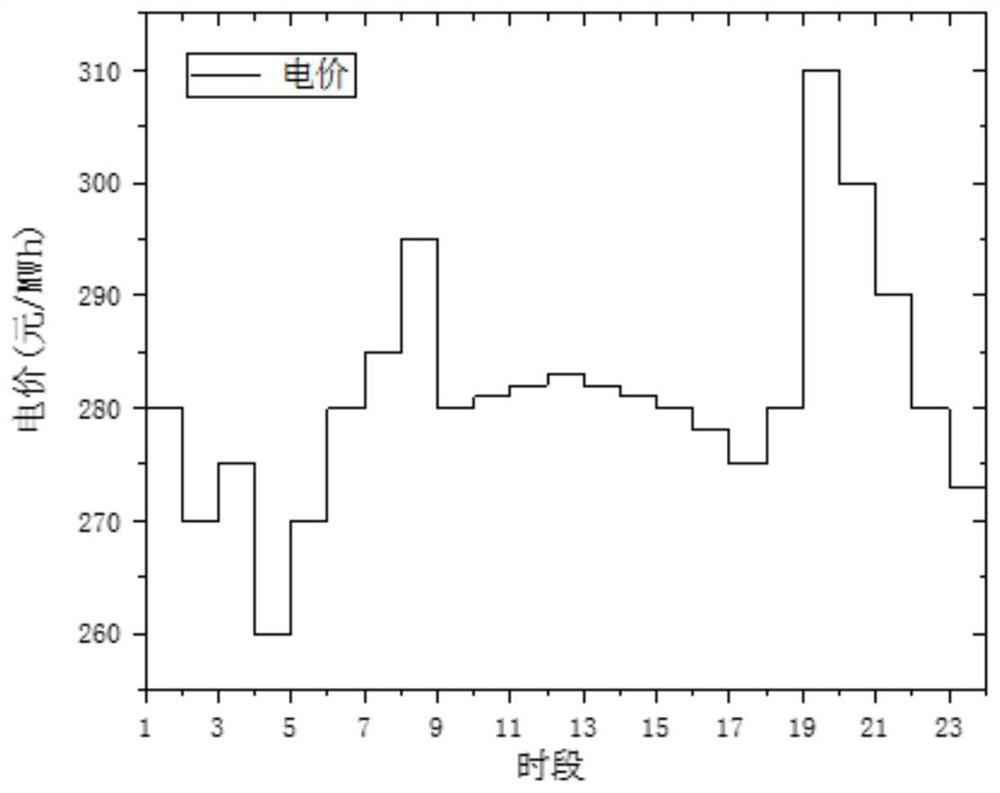

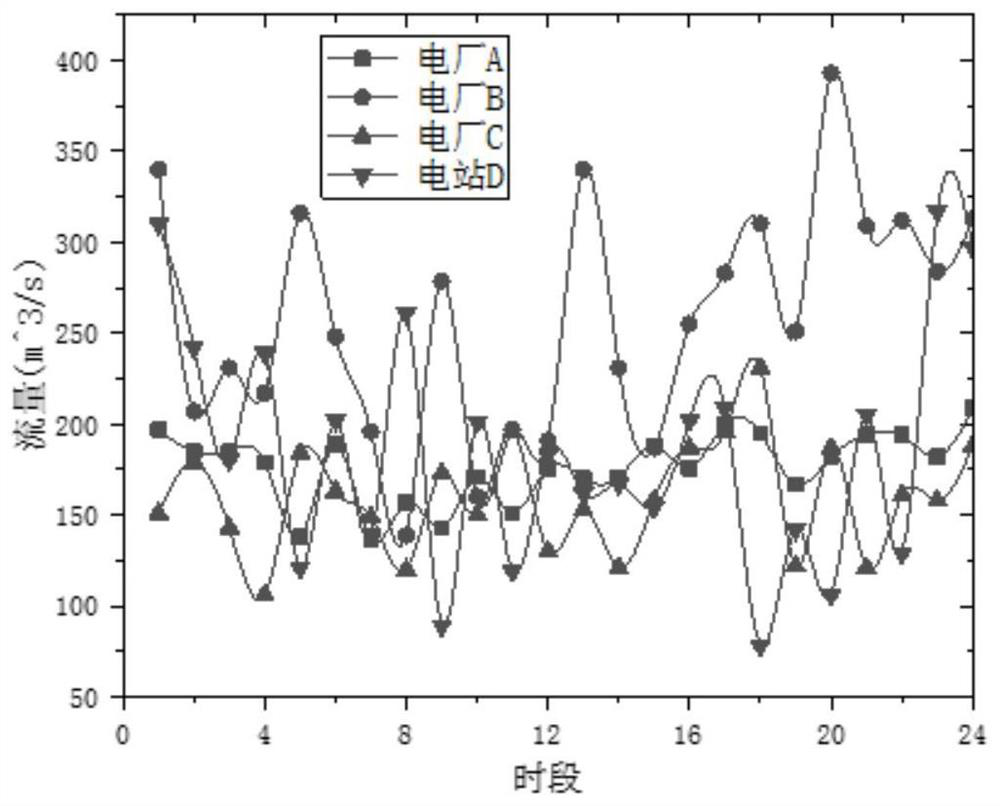

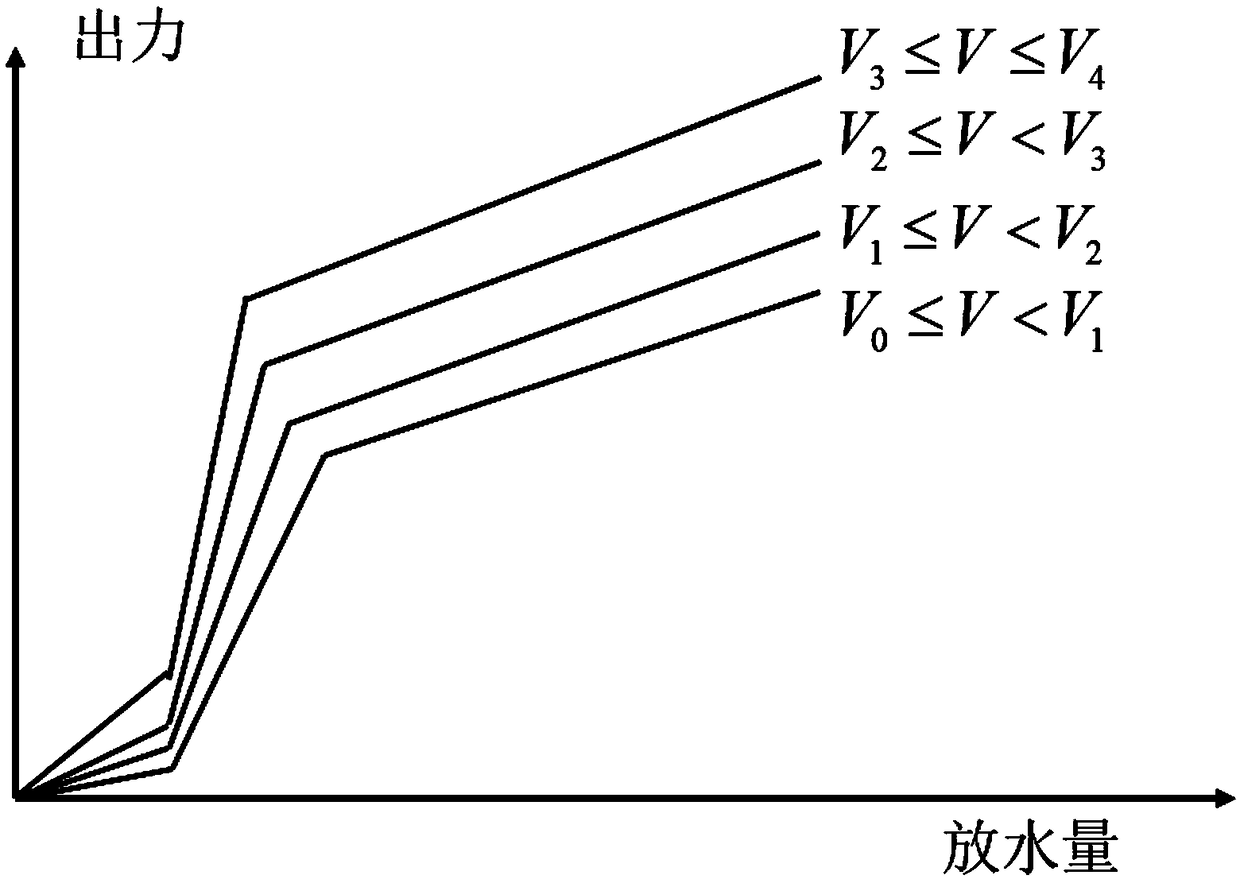

Cascade hydropower station short-term robust scheduling method coupling daily electric quantity decomposition and day-ahead market bidding

PendingCN112465323AMeet the minimum earning requirementsEffective executionDesign optimisation/simulationConstraint-based CADDecision makerOptimal scheduling

The invention provides a cascade hydropower station short-term robust scheduling method coupling daily electric quantity decomposition and day-ahead market bidding, and the method comprises the steps:building a deterministic hydropower short-term optimal scheduling model by taking the maximum total income of a cascade hydropower station as a target; converting the deterministic short-term optimization scheduling model into a robust scheduling model considering the uncertainty of the electricity price; and solving by adopting a mixed integer nonlinear programming method. According to the method, the daily electric quantity of the cascade hydropower station can be scientifically and reasonably decomposed into the electric power curve, effective execution of the daily contract is guaranteed,the declared quantity-price pair participating in the day-ahead spot market is obtained, and the obtained scheduling result of the cascade hydropower station has robustness and is reflected in that when the clearing price is within the estimated price information gap, the method can guarantee that the expected target is not worse than a certain minimum preset result, can quantitatively describe the relation between the uncertain parameter change range and the minimum acceptable target, and can provide a more flexible and intuitive scheduling and transaction decision basis for decision makersof cascade hydropower enterprises with disgusting risks.

Owner:DALIAN UNIV OF TECH +1

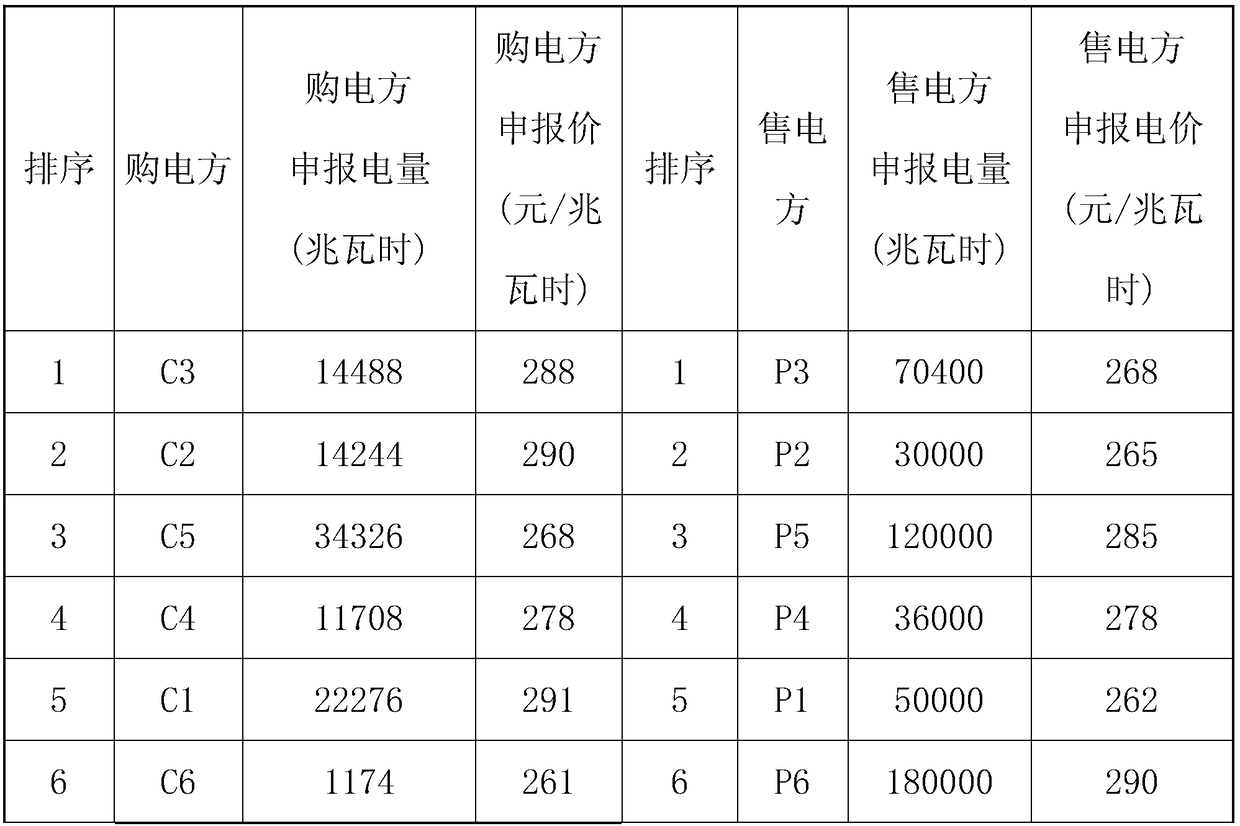

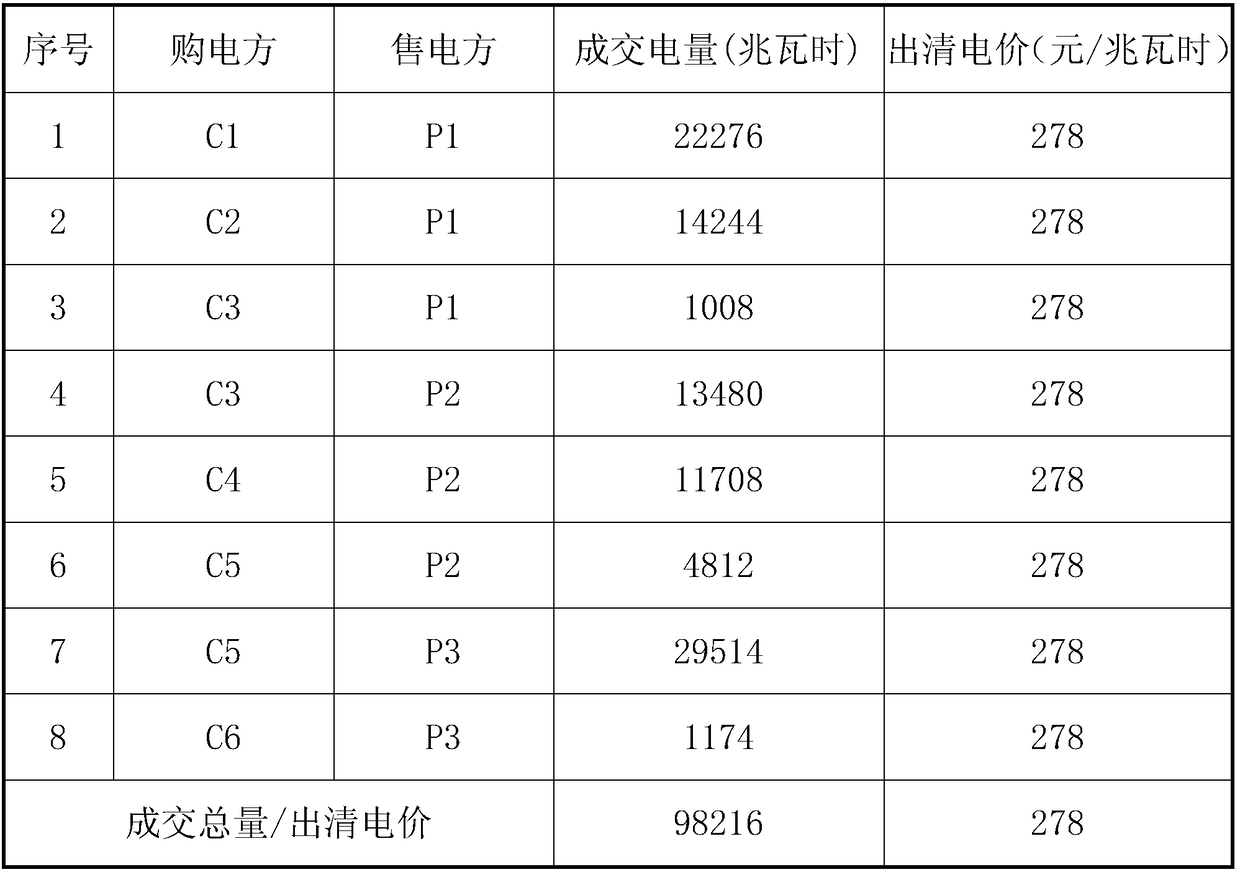

Algorithm model and control method for direct transaction of electric power market large users

InactiveCN108346008AEnsure reasonable flowOptimizationBuying/selling/leasing transactionsResourcesFinancial transactionEmbedded system

The invention discloses an algorithm model and a control method for the direct transaction of electric power market large users. The algorithm model comprises the following steps: S100, establishing ascreening rule established for the electricity purchasing party declaration data and the electricity selling party declaration data, and establishing an algorithm model for the direct transaction ofthe electric power market large users; S200, screening the electricity purchasing party declaration data and the electricity selling party declaration data according to the screening rule, and findingout the marginal clearing price; and S300, carrying out the direct transaction matching of the electricity purchasing party and the electricity selling party. A direct trading mechanism, a trading rule set, a clearing rule set and an algorithm model thereof of the electric power market large users are established, the validity screening of the declaration data is carried out, the centralized matching bidding sorting strategies are flexibly adjusted, and the marginal clearing price can be unified, and reasonable flow and optimal configuration of resources are ensured.

Owner:STATE GRID SHAANXI ELECTRIC POWER RES INST +1

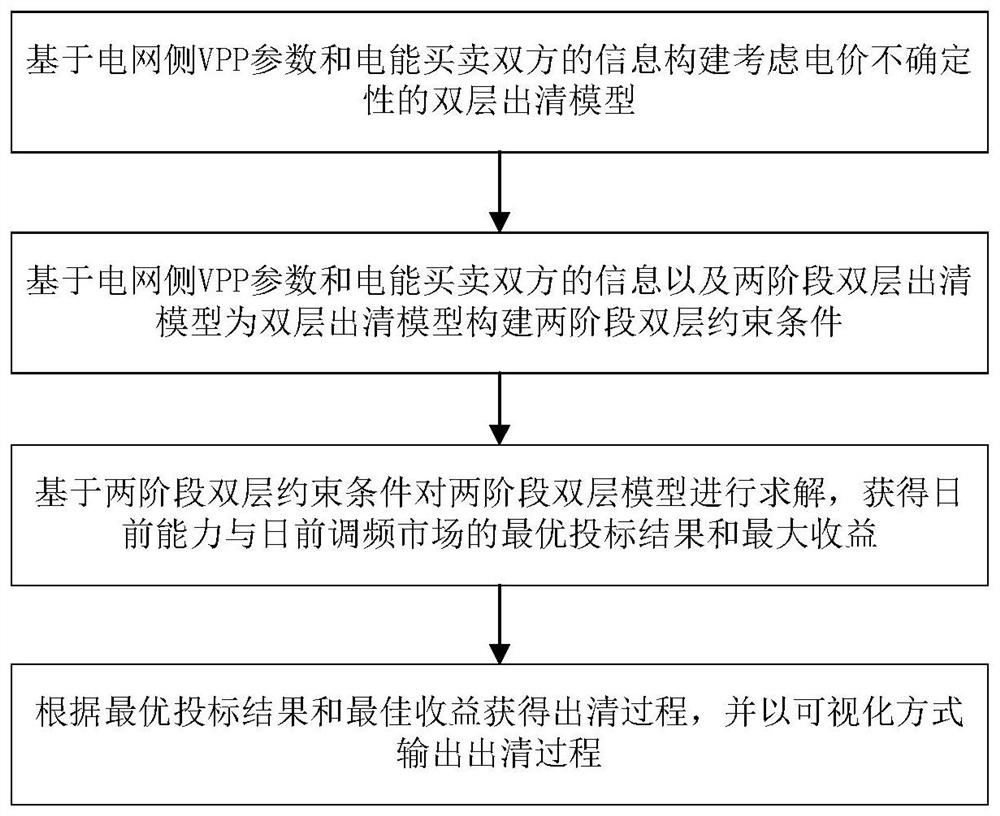

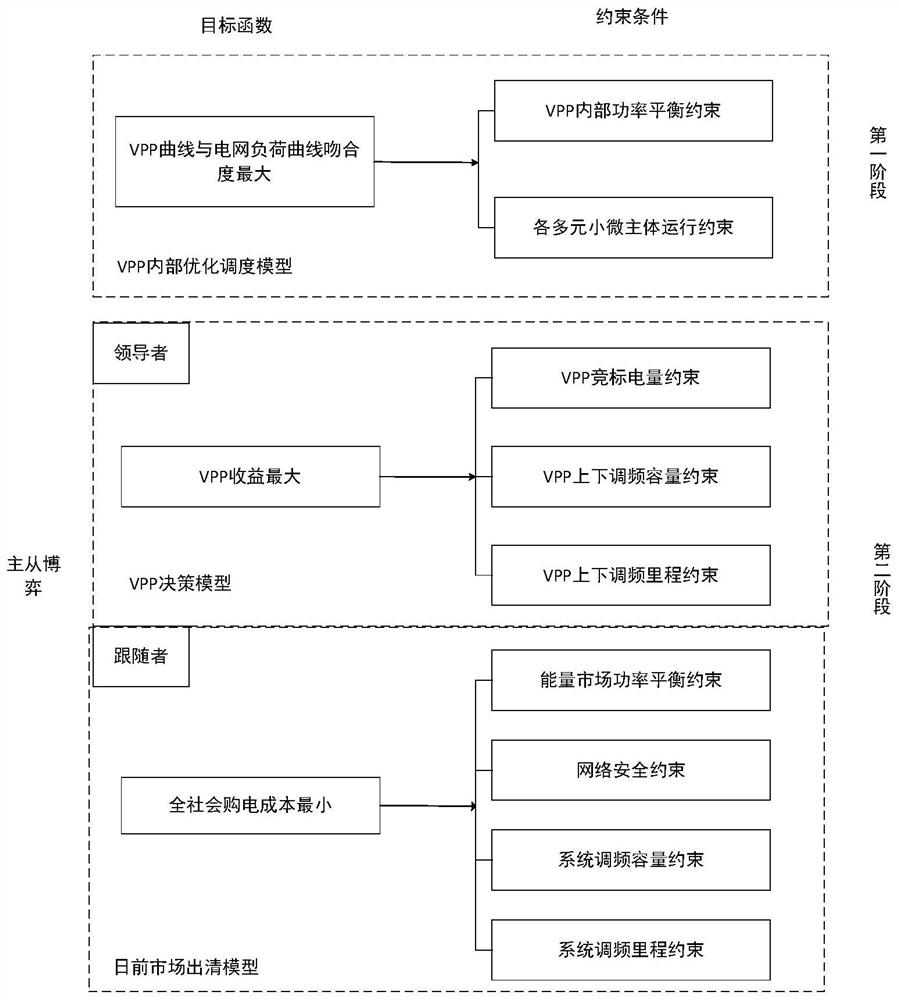

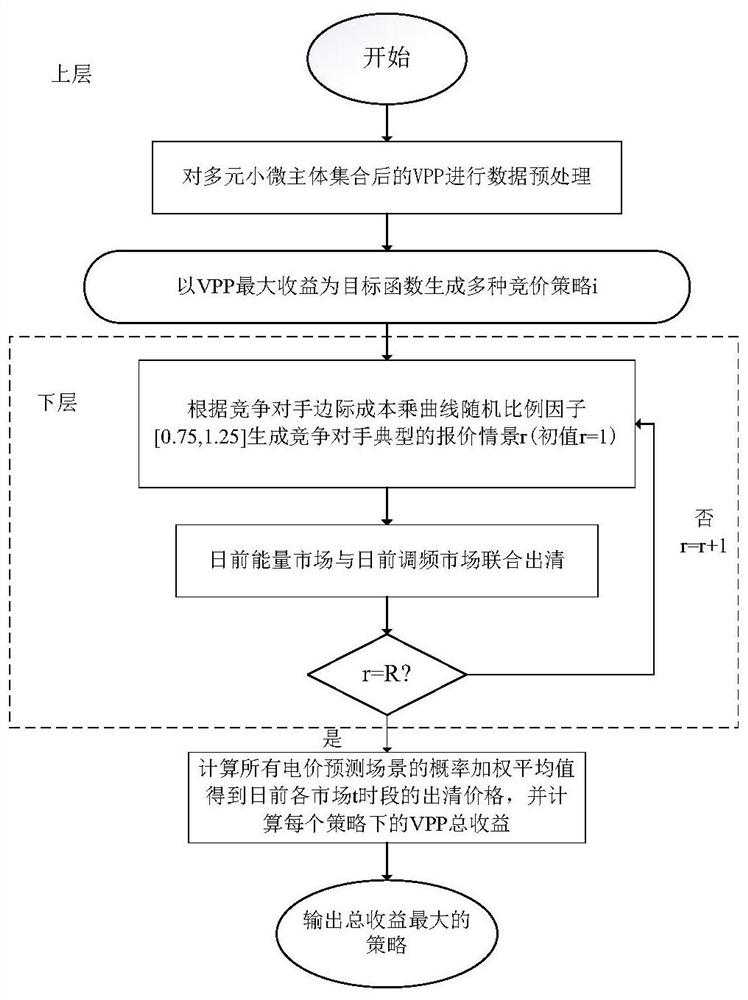

Clearing method for participation of multi-element small and micro subjects in spot market based on virtual power plant

PendingCN112529622AReduce lossReduce electricity purchase costMarket predictionsDigital data information retrievalElectricity priceMarket place

The invention provides a clearing method for participation of multi-element small and micro subjects in spot market based on virtual power plant, and solves the risk problem brought by uncertainty ofcompetitors to VPP earnings in a transaction decision game process. The method comprises the steps: firstly, constructing a double-layer clearing model considering electricity price uncertainty and constraint conditions of the double-layer clearing model based on power grid side VPP parameters and information of electric energy buyers and sellers; secondly, solving the double-layer clearing modelbased on constraint conditions of the double-layer clearing model to obtain an optimal bidding result and an optimal income of a day-ahead frequency modulation market of day-ahead energy and duration;and finally, obtaining the bid winning condition, the optimal quotation and the clearing price of each market subject according to the optimal bidding result and the optimal income. According to themethod, through the two-stage double-layer clearing model and the two-stage double-layer constraint condition established by the clearing method, visual benefit analysis and bidding decision of the peak regulation market in which the power grid side energy storage participates in considering the electricity price uncertainty can be simply and conveniently achieved.

Owner:ECONOMIC TECH RES INST OF STATE GRID HENAN ELECTRIC POWER +2

Systems and Methods for Market Order Volume Clearing in Online Trading of Credit Derivatives

Systems and methods for market order volume clearing in online trading of credit derivatives are disclosed. In one embodiment, a method for market order volume clearing may comprise: selecting, from a plurality of credit derivatives, at least one most liquid credit derivative; determining a volume clearing price level for the selected credit derivative; inviting trading clients of the electronic trading system to submit, within a time limit, buy orders and sell orders for the selected credit derivative at the volume clearing price level, each buy order or sell order specifying a desired volume; matching the buy orders and the sell orders submitted within the time limit to maximize a total notional amount of the selected credit derivative that can be traded at the volume clearing price level; and completing trades at the volume clearing price level according to the matching of orders.

Owner:CREDITEX GROUP

Trading rights facility

The trading rights facility of the present invention comprises guaranteeing an access for the quantity and price of a potential imbalanced or complex order, which price is acceptable to both the buyer and the seller, and to the market as a whole; and agreeing to fully deliver the quantities at the discovered price within a pre-set delayed time frame. In effect, the trading rights facility of the present invention creates a secondary “liquidity base” that augments the ordinary access liquidity base, and allows for that initial liquidity base to remain untouched by the complex order itself, which is in sharp contrast to current experience where it would take all and ask for more. The initial liquidity base would be there to cushion the access community. The complex access would be at a premium to current market price and would be competitively bid in relation to the whole of the initial liquidity base environment. The trading rights facility of the present invention ensures the transparency of all operations. The trading rights facility of the present invention further allows for the creation for a variable access index product that also provides a supply zero sum diffusion base. In a further embodiment, the trading rights facility of the present invention allows a contract on a settlement price to be traded before the settlement price has been derived. Where a premium based transaction introduces a new third party to the trading mix whose role is limited to that of just the differential and not to the remaining structural balance, the trading rights facility of the present invention retains the right to eliminate the time cost necessity of such third parties to remain in the initial structure by cashing out such third party differentials without impairing transactional integrity.

Owner:STEIDLMAYER J PETER +2

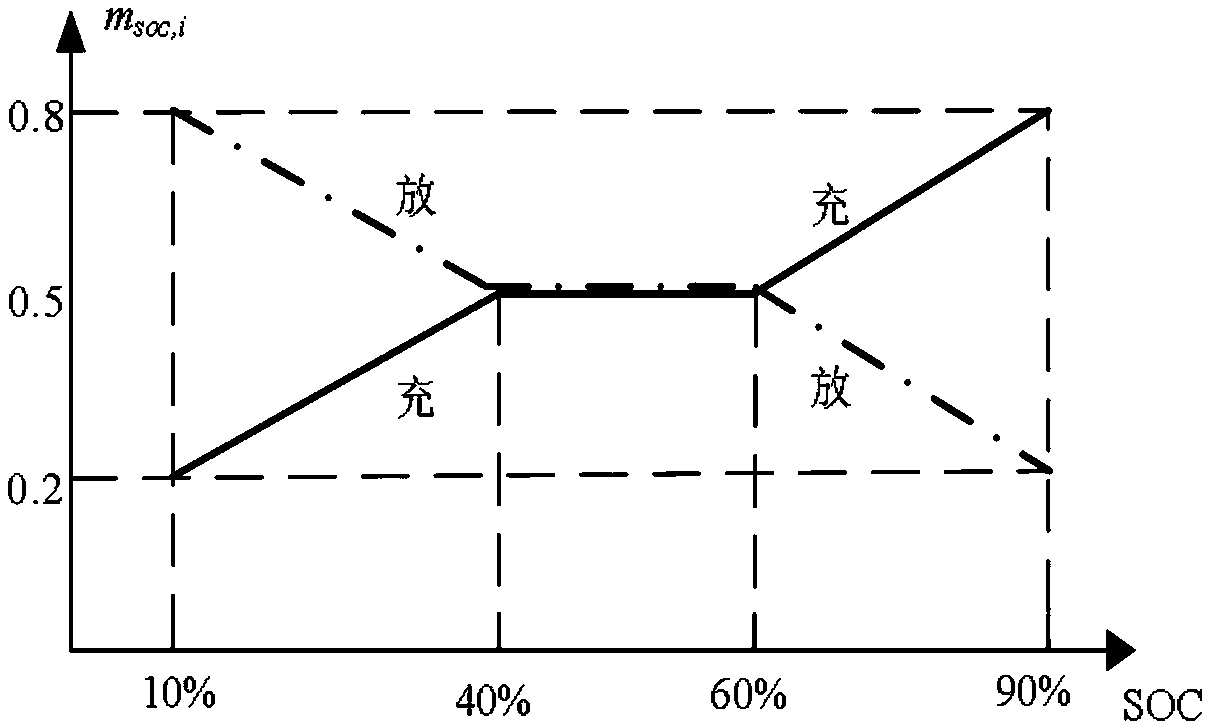

Frequency modulation instruction scheduling method considering energy storage power station life attenuation and capacity balance bidding

ActiveCN110210709AExtended run timeReduce SOC-limited situationsResourcesUltrasound attenuationPower station

The invention relates to an energy storage power station frequency modulation power scheduling and distributing method participating in power grid frequency modulation, in particular to a frequency modulation instruction scheduling method considering energy storage power station life attenuation and capacity balance bidding. The invention provides a frequency modulation instruction scheduling anddistributing strategy considering energy storage power station life attenuation and capacity balance bidding, capable of combining the clearing price involved in the auxiliary service market with thescheduling strategy to realize scheduling according to the cost of each frequency modulation resource in the scheduling process. The frequency modulation instruction scheduling and distributing methodcan reduce the total operation cost of each energy storage power station undertaking the AGC instruction, is beneficial to balancing the SOC state of each power station in the auxiliary service market, can prolong the operation time of each power station, can help the power station to clarify the dynamic cost of the power station participating in frequency modulation, and can stimulate the powerstation to fairly and reasonably participate in the frequency modulation auxiliary service market by a marketization method.

Owner:TAIYUAN UNIV OF TECH

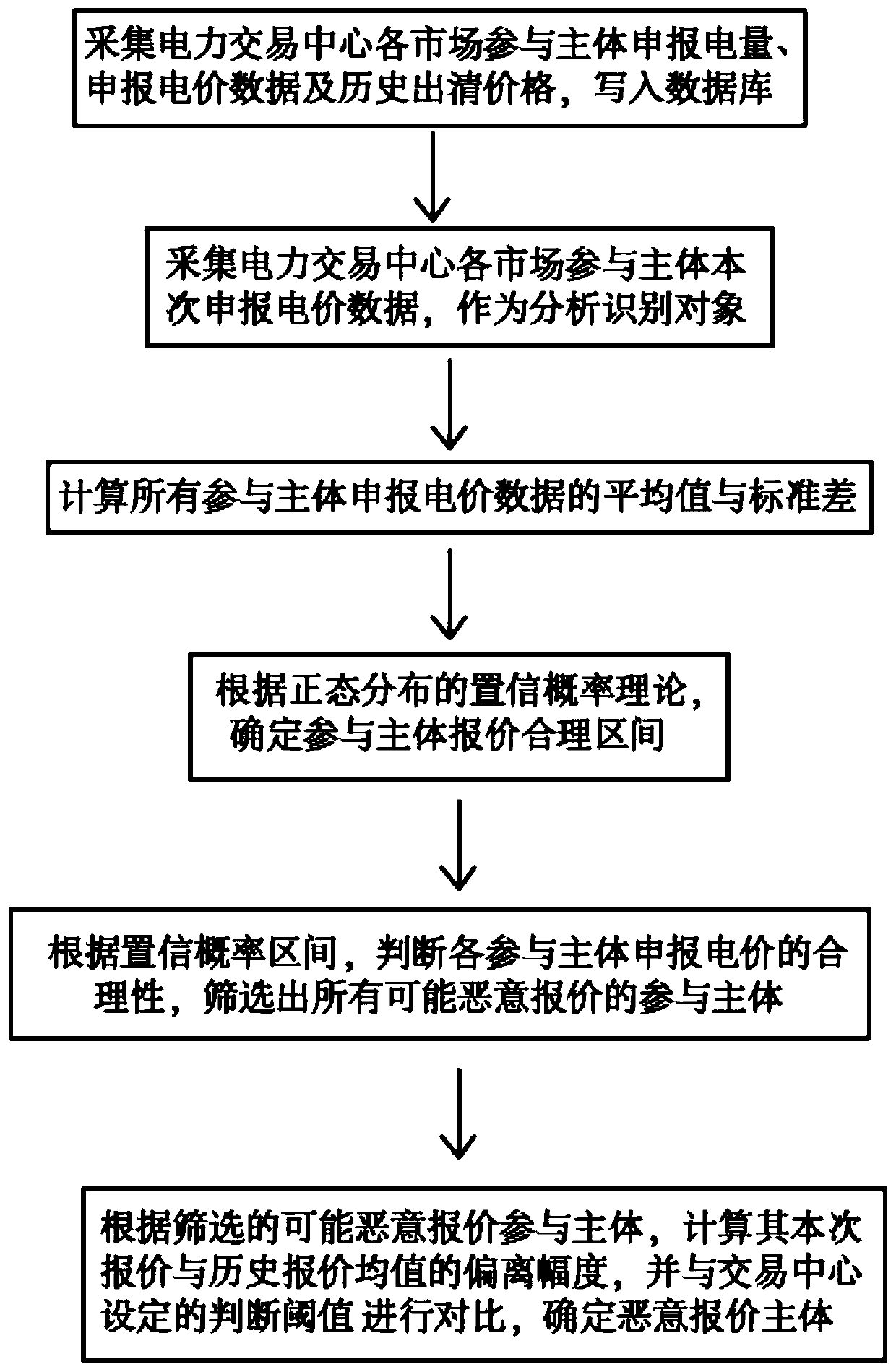

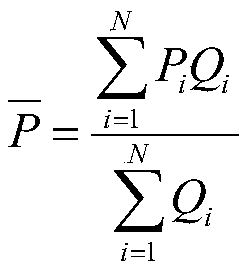

Electric power market malicious bidding behavior identification method

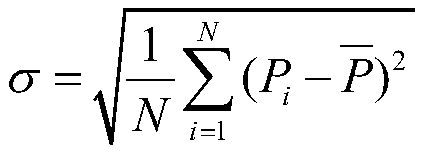

ActiveCN110148006AImprove market healthOptimizing the Operating Mechanism of the Power MarketCommerceComplex mathematical operationsRegular distributionElectricity price

The invention relates to an electric power market malicious bidding behavior identification method comprising the following steps: S1, collecting electric quantity declared by each market participantof an electric power transaction center, declared electricity price data and historical clearing price, and writing the electric quantity, the declared electricity price data and the historical clearing price into a database; taking the current declared electricity price data of the participation subject as an analysis and identification object; s2, calculating an average value and a standard deviation sigma of all quotation data; s3, according to a confidence probability theory of normal distribution, determining a reasonable offer interval of the offers as S4, according to the confidence probability interval, judging the reasonability of the declared electricity price of each offer, and screening out all the offers who may maliciously offer; s5, calculating the deviation amplitude between the current quotation and the historical quotation mean value according to the possible malicious quotation yielding party screened in the step S4, and determining a malicious quotation subject. Inthe declaration stage, the abnormal quotation behavior can be recognized in time according to the declaration electricity price, early warning is sent out, the market health degree is improved, and the power market operation mechanism is optimized.

Owner:STATE GRID TIANJIN ELECTRIC POWER +1

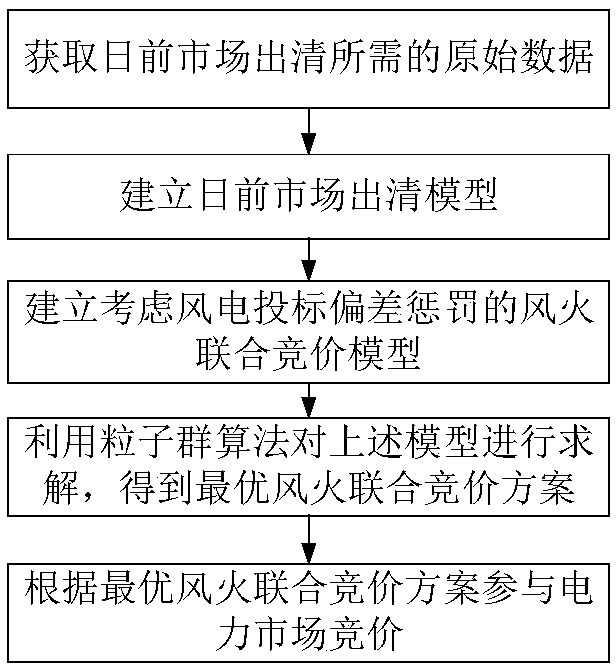

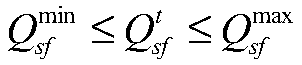

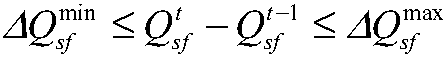

A wind-fire combined bidding method considering the penalty of wind power bidding deviation

InactiveCN109242657AReduce output deviation penaltyIncrease incomeCommerceInformation technology support systemOriginal dataParticle swarm algorithm

The invention discloses a wind-fire combined bidding method considering the penalty of wind power bidding deviation, which comprises the following steps: the original data required for market clearingbefore the day of bidding is obtained; According to the original data, the objective function and constraint conditions of maximizing social welfare are determined for the system unified marginal clearing model; the objective function of the maximum profit of wind-thermal power generation company is established; Particle Swarm Optimization (PSO) is used to calculate the clearing quantity and clearing price of social welfare maximization objective function which meets the constraint conditions, and then the objective function of the maximum profit of wind-fire combined power generation companyis solved, and the optimal wind-fire combined bidding scheme is obtained. According to the optimal wind-fire combined bidding scheme, the bidding is carried out in the electricity market. This methodcan be used to guide the bidding behavior of wind power suppliers in the electricity market and improve the profits of wind power suppliers.

Owner:ELECTRIC POWER RESEARCH INSTITUTE, CHINA SOUTHERN POWER GRID CO LTD +1

Trading rights facility

Owner:STEIDLMAYER J PETER +2

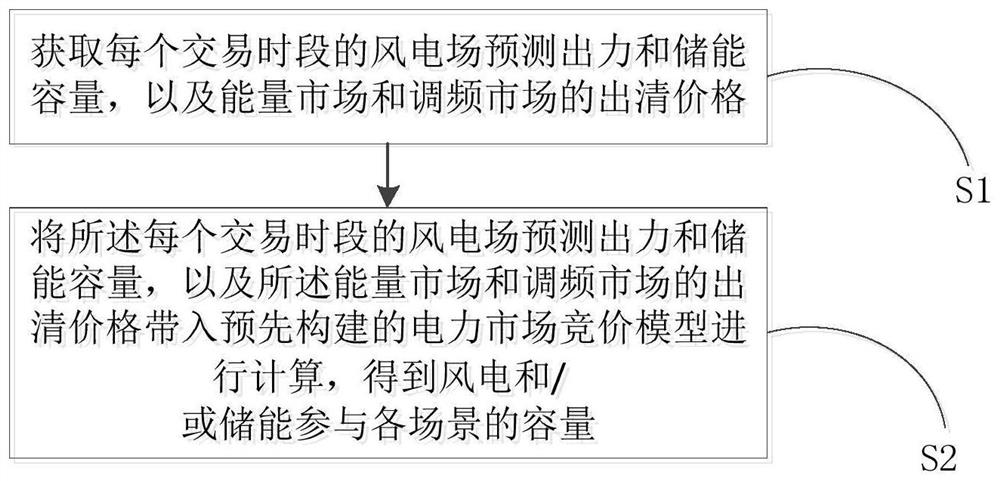

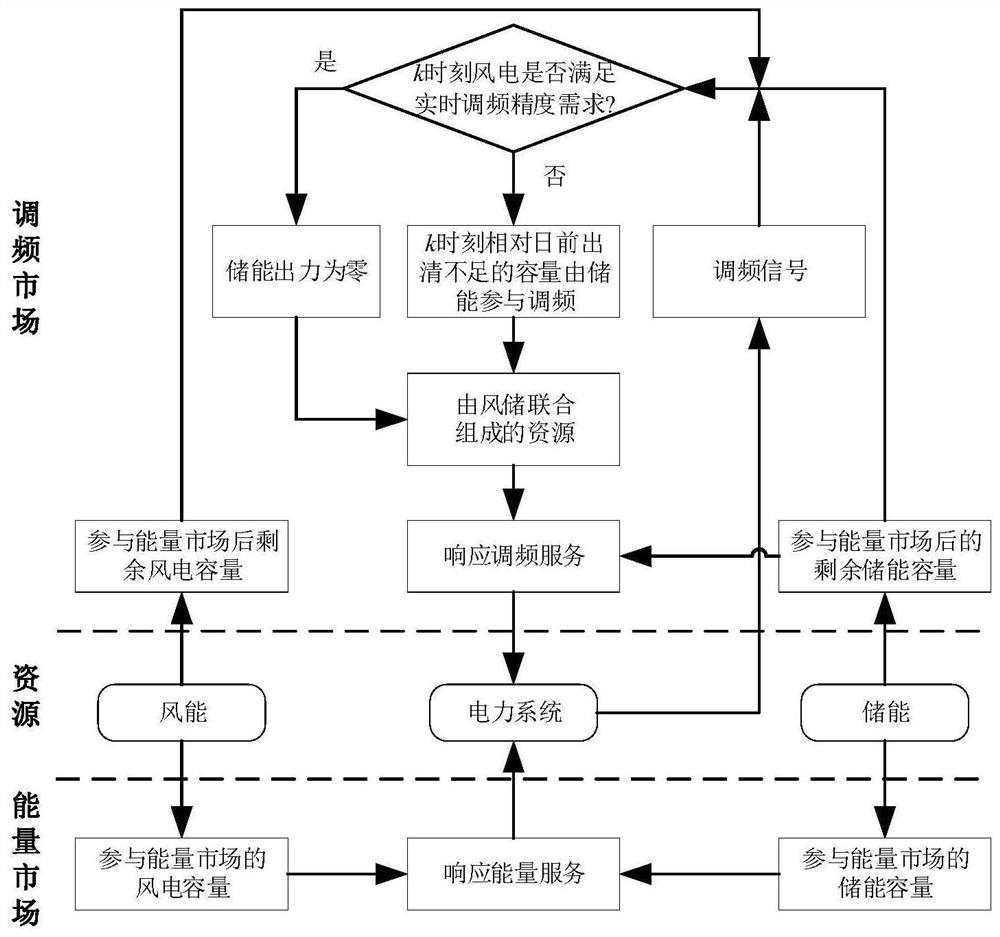

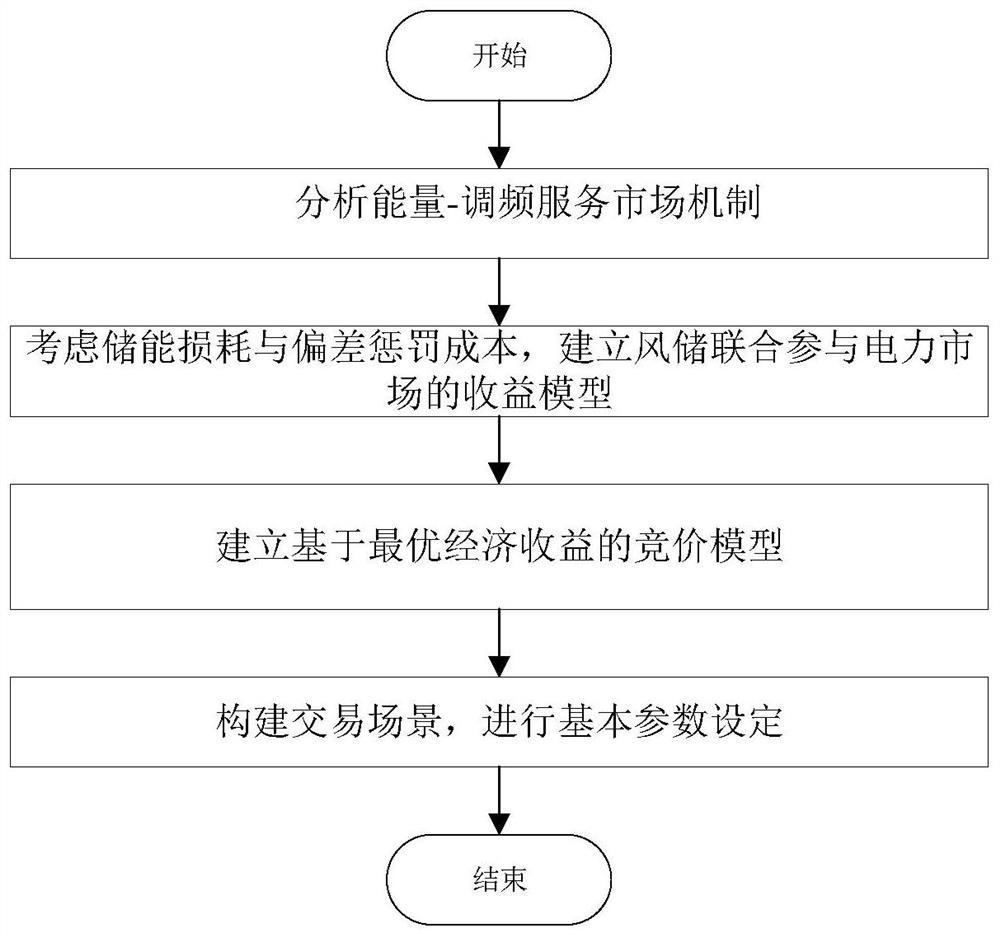

Optimal bidding method and system for wind storage joint participation in energy-frequency modulation market

PendingCN112001528AImprove FM capabilityReduce loss costMarket predictionsForecastingStored energyFrequency modulation

The invention discloses an optimal bidding method and system for wind storage joint participation in an energy-frequency modulation market. The bidding method comprises the steps of obtaining predicted output and energy storage capacity of a wind power plant in each transaction time period, and clearing prices of the energy market and the frequency modulation market; substituting the predicted output and the energy storage capacity of the wind power plant in each transaction period and the clearing prices of the energy market and the frequency modulation market into a pre-constructed electricity market bidding model for calculation to obtain the capacity of wind power and / or energy storage participating in each scene; wherein the scene comprises a wind power participation energy market, anenergy storage participation energy market, a wind storage joint participation frequency modulation market and an energy storage participation frequency modulation market; wherein the electricity market bidding model is constructed by taking the optimal income when wind power and / or energy storage participates in each scene as a target. According to the invention, the frequency modulation performance of wind power is effectively improved, and the energy storage loss cost is reduced to a certain extent.

Owner:CHINA ELECTRIC POWER RES INST +2

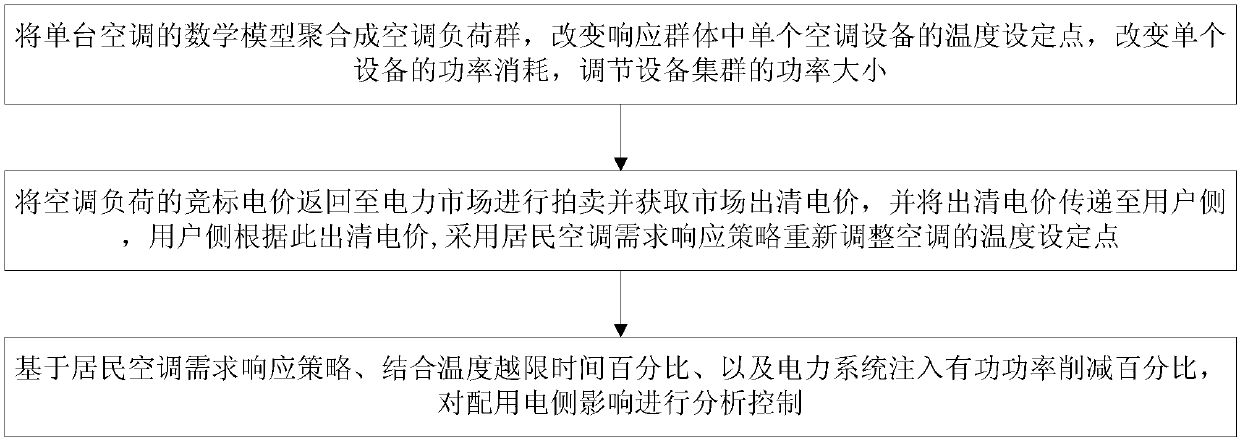

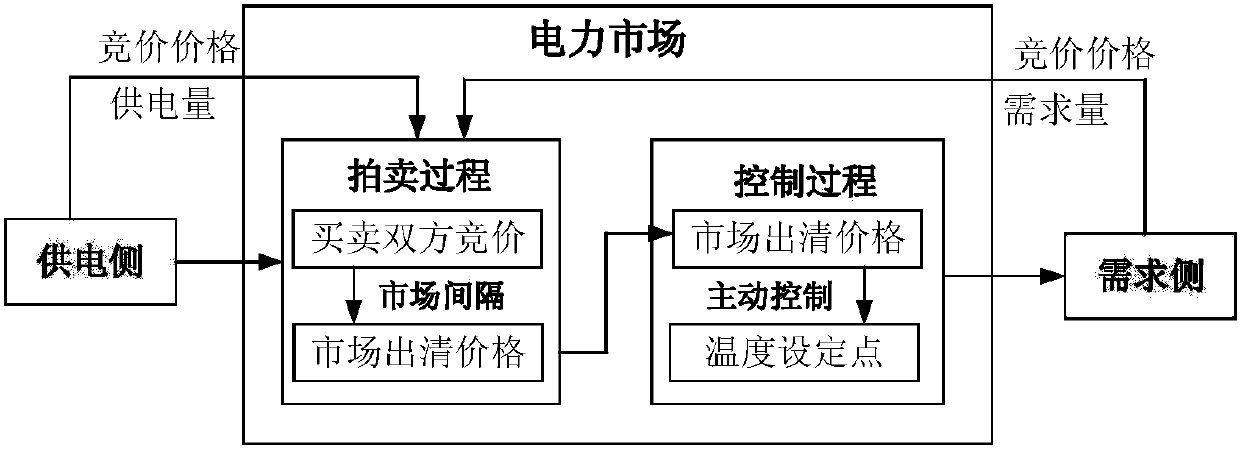

Control method for resident air conditioner demand response strategy and influence thereof on distribution and consumption sides

The invention discloses a control method for a resident air conditioner demand response strategy and the influence thereof on distribution and consumption sides, comprising the steps of: aggregating mathematical models of single air conditioners into an air conditioner load group, changing a temperature set point of a single air conditioner device in the response group, changing the power consumption of the single device and adjusting the power of the device group; returning the bid price of the air conditioner load to an electricity market for auctions and obtaining a market clearing price, and transmitting the clearing price to a user side, and readjusting, by the user side, the temperature set point of the air conditioner by adopting the resident air conditioner demand response strategyaccording to the clearing price; and analyzing and controlling the influence on the distribution and consumption sides based on the resident air conditioner demand response strategy in combination with the percentage of temperature overrun time and the injected active power reduction percentage of a power system. The method introduces a linearized interactive demand response strategy of residentair conditioners for real-time electricity price signals, and expresses the temperature set points as a function of electricity price, thereby realizing the control on a single air conditioner temperature set point in the resident air conditioner group.

Owner:TIANJIN UNIV

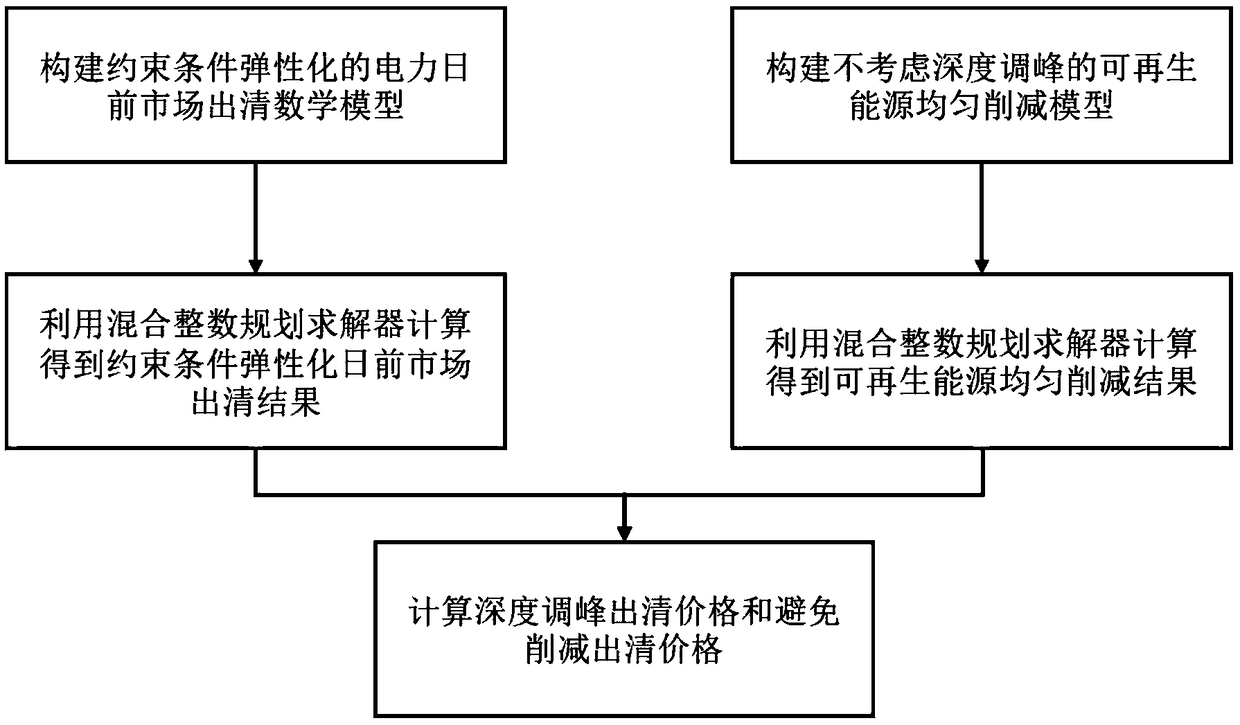

Power day-ahead market clearing method with flexible constrained condition

ActiveCN109301876APromote digestionImprove securityData processing applicationsSingle network parallel feeding arrangementsMathematical modelPower system scheduling

The invention relates to a power day-ahead market clearing method with flexible constrained condition, and belongs to the technical fields of power system scheduling and power marker transaction. Themethod comprises that a power day-ahead market clearing mathematical model with flexible constrained condition is constructed, a constrained condition flexible day-ahead marking clearing result is obtained by calculation, a renewable energy uniform reduction model without consideration of deep peak shaving is constructed, a renewable energy uniform reduction result is obtained by calculation, anda deep peak shaving clearing price and a reduction avoiding clearing price are calculated. The thermal power set and renewable energy modeling method and thermal power deep peak shaving and renewableenergy reduction balanced modeling method as well as the renewable energy uniform reduction model with the flexible constraint condition are provided, technical support is provided for day-ahead marker clearing or day-ahead plan arrangement with the flexible constraint condition considering the thermal power deep shaving and ordered renewable energy reduction, the difficulty in coordinating thermal power and renewable energy in the day-ahead marker is overcome, and consumption of the renewable energy is prompted.

Owner:TSINGHUA UNIV +2

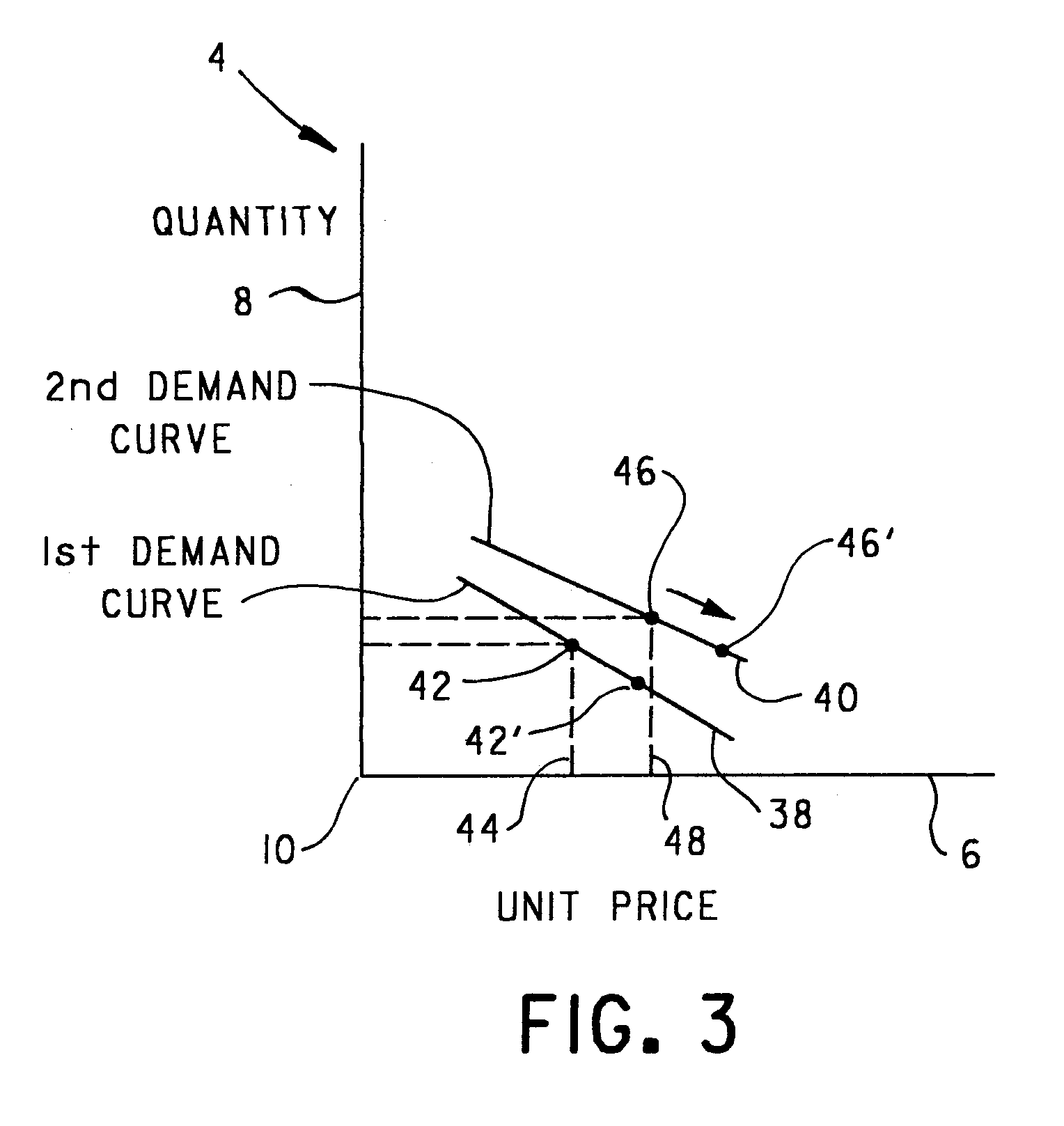

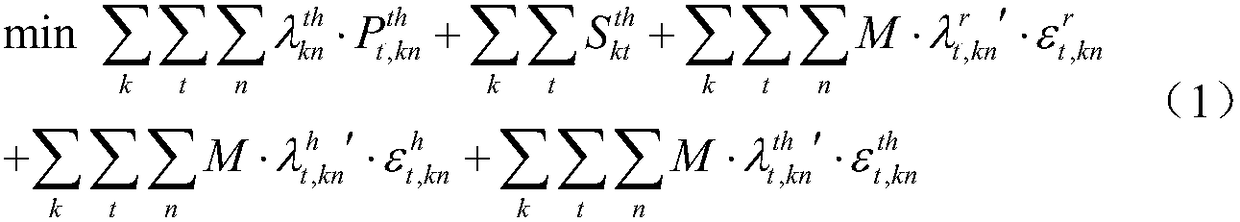

System and Method for Pricing and Allocation of Commodities or Securities

An auction server node is described for a computer network having user nodes for conducting an auction run by an auction adviser for awarding securities from an issuer to bidders of the auction. There is real-time monitoring of the auction as it occurs, a bid mechanism for receiving competitive bids from the bidders at the user nodes, including a quantity of securities to be purchased, an initial price revealed to the other bidders, and a firm price not revealed to the other bidders and within a predetermined range of the initial price. A single market clearing price is determined that allocates to the bidders all of the securities in the auction. An incremental adjustment of the market clearing price may be made by at least one of the auction advisor and the issuer, and an allocation made of the securities to the bidders at the adjusted clearing price.

Owner:W R HAMBRECHT CO

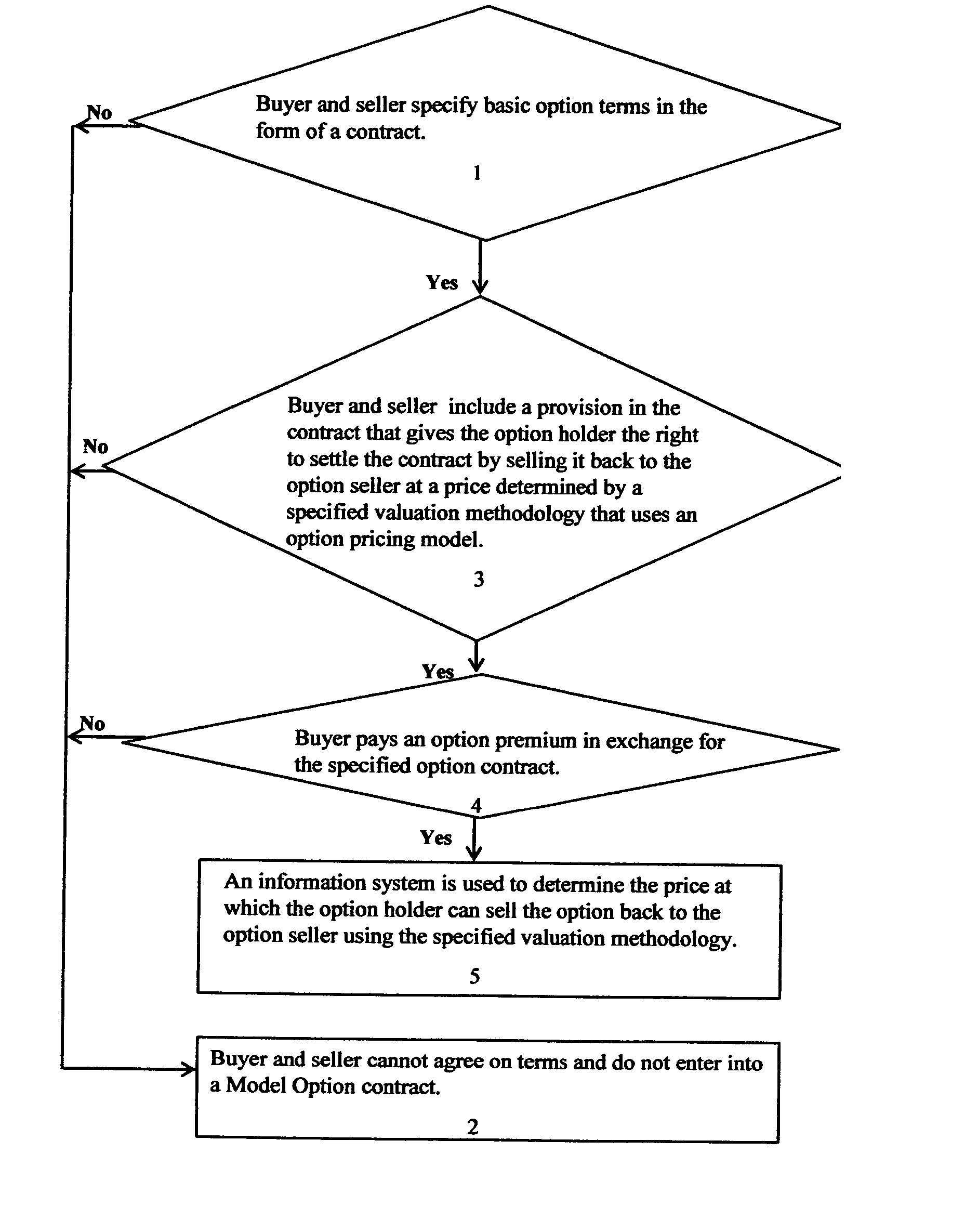

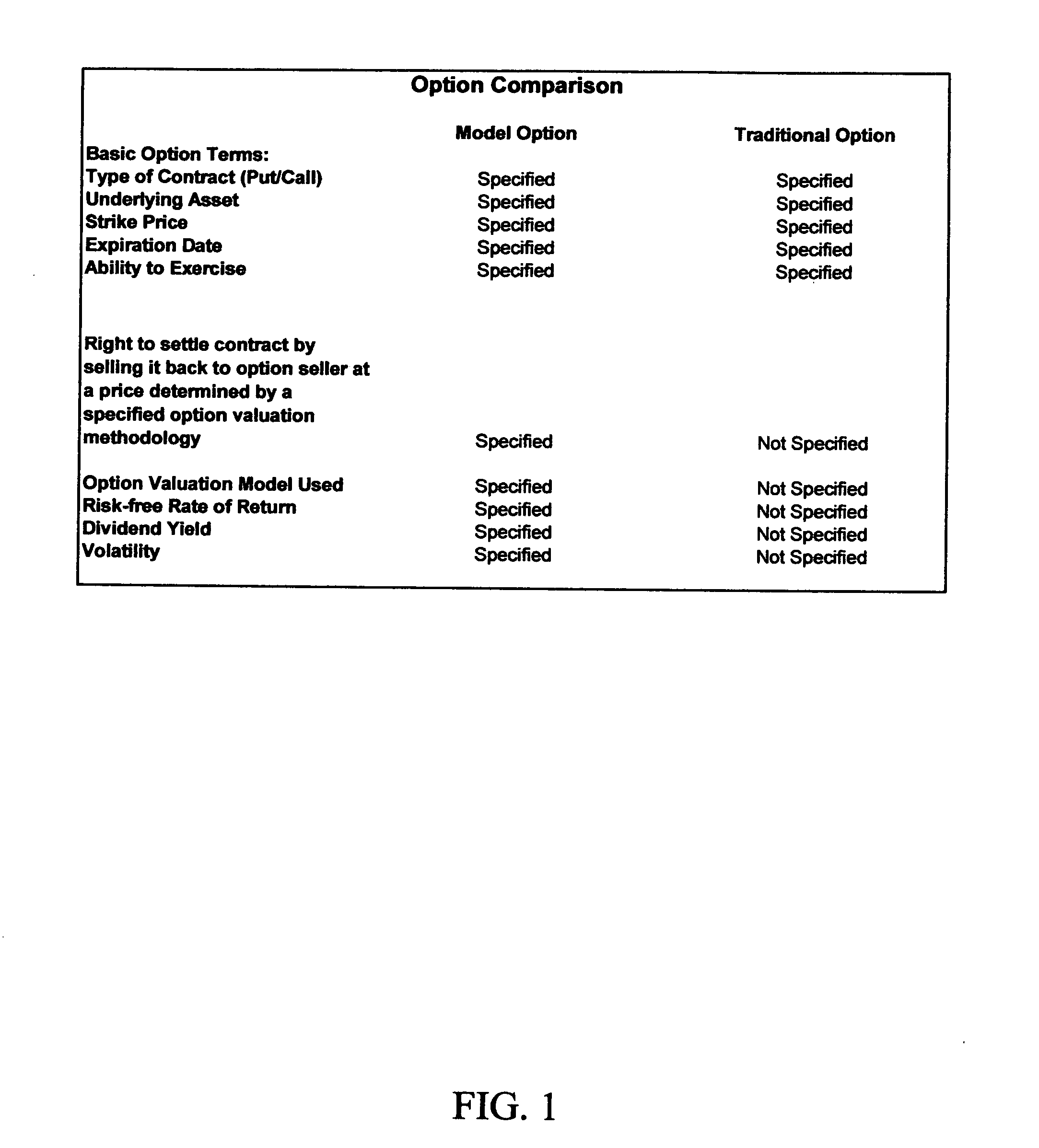

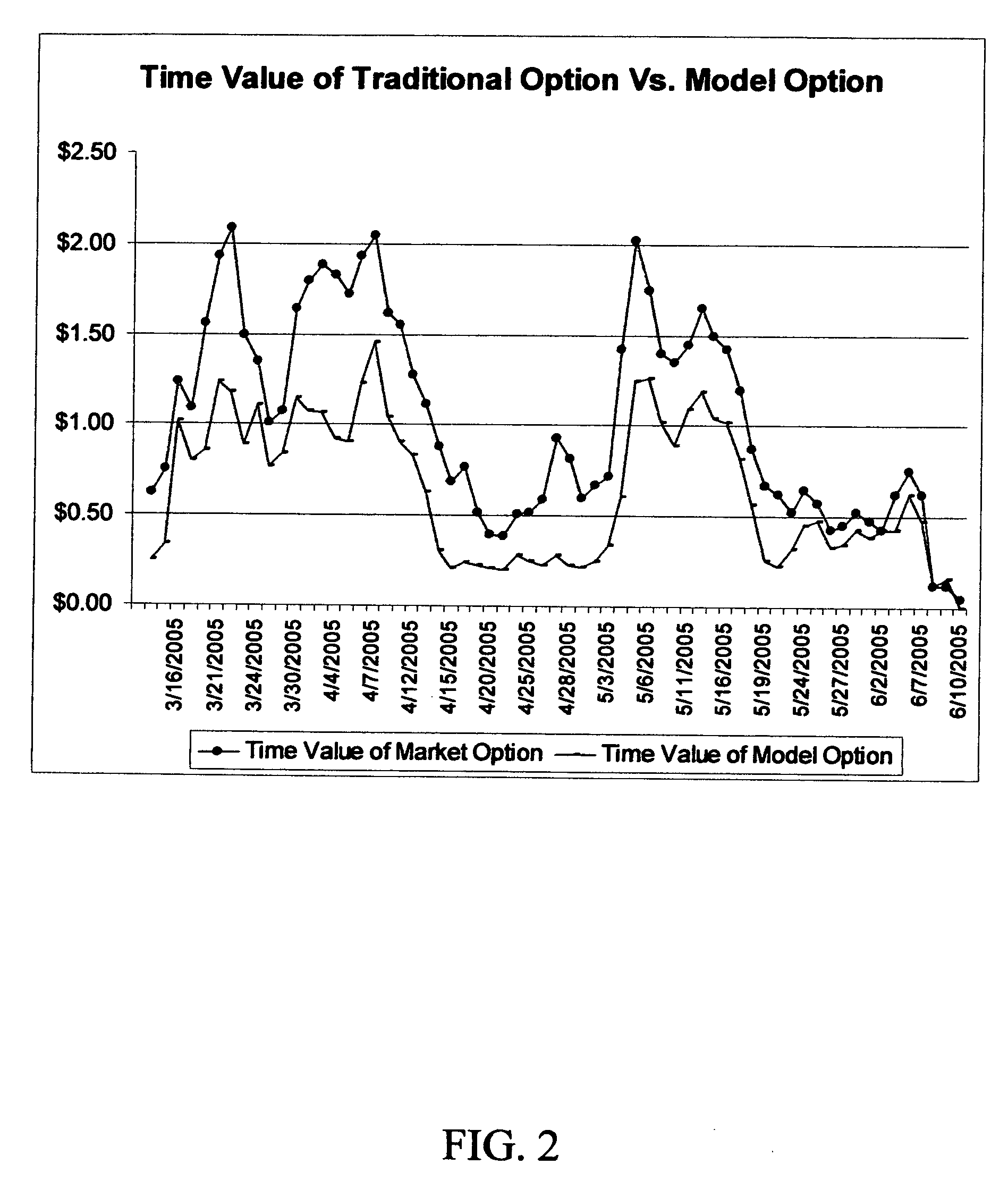

Model option contracts

Owner:THOMAS BRUCE BRADFORD

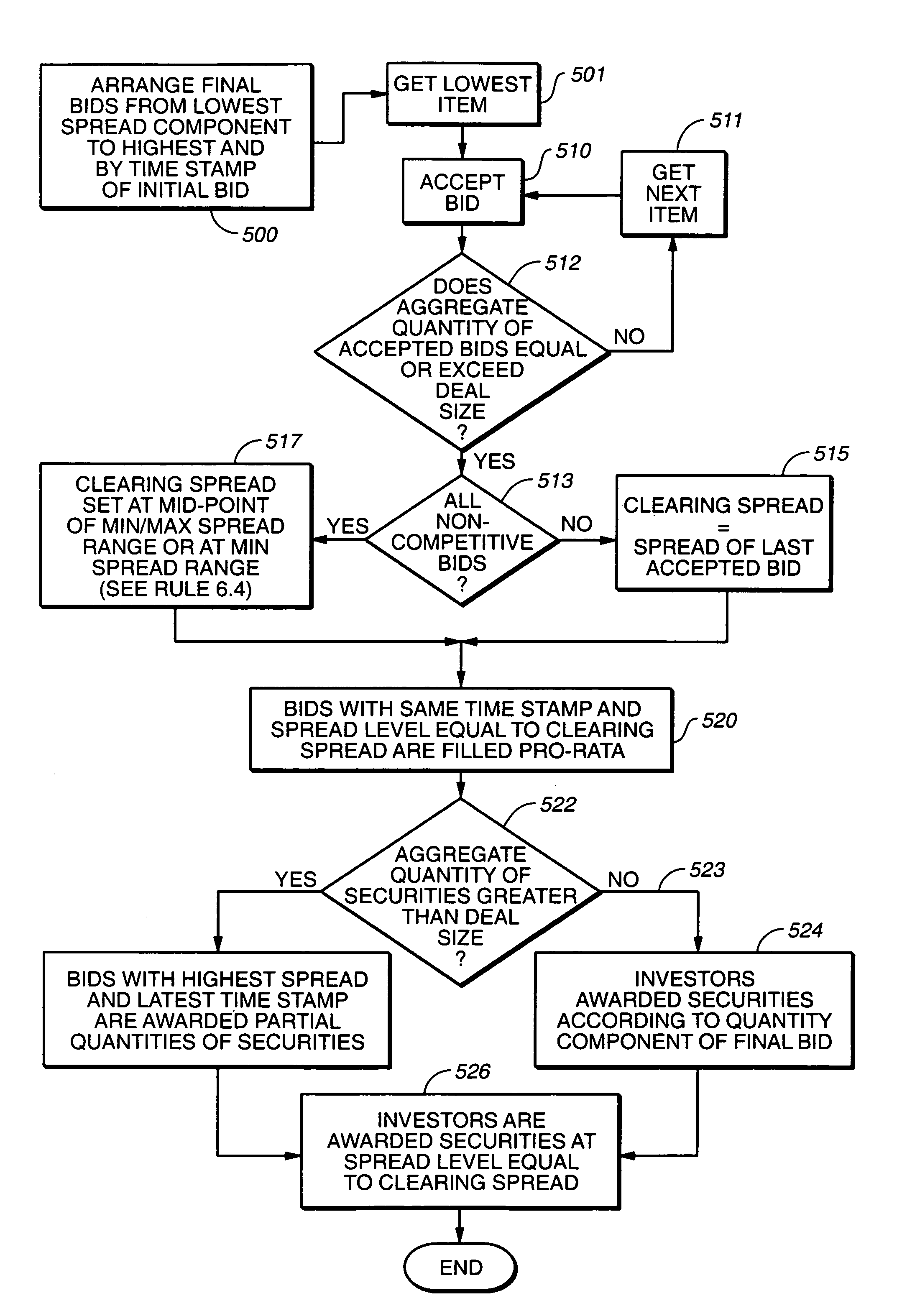

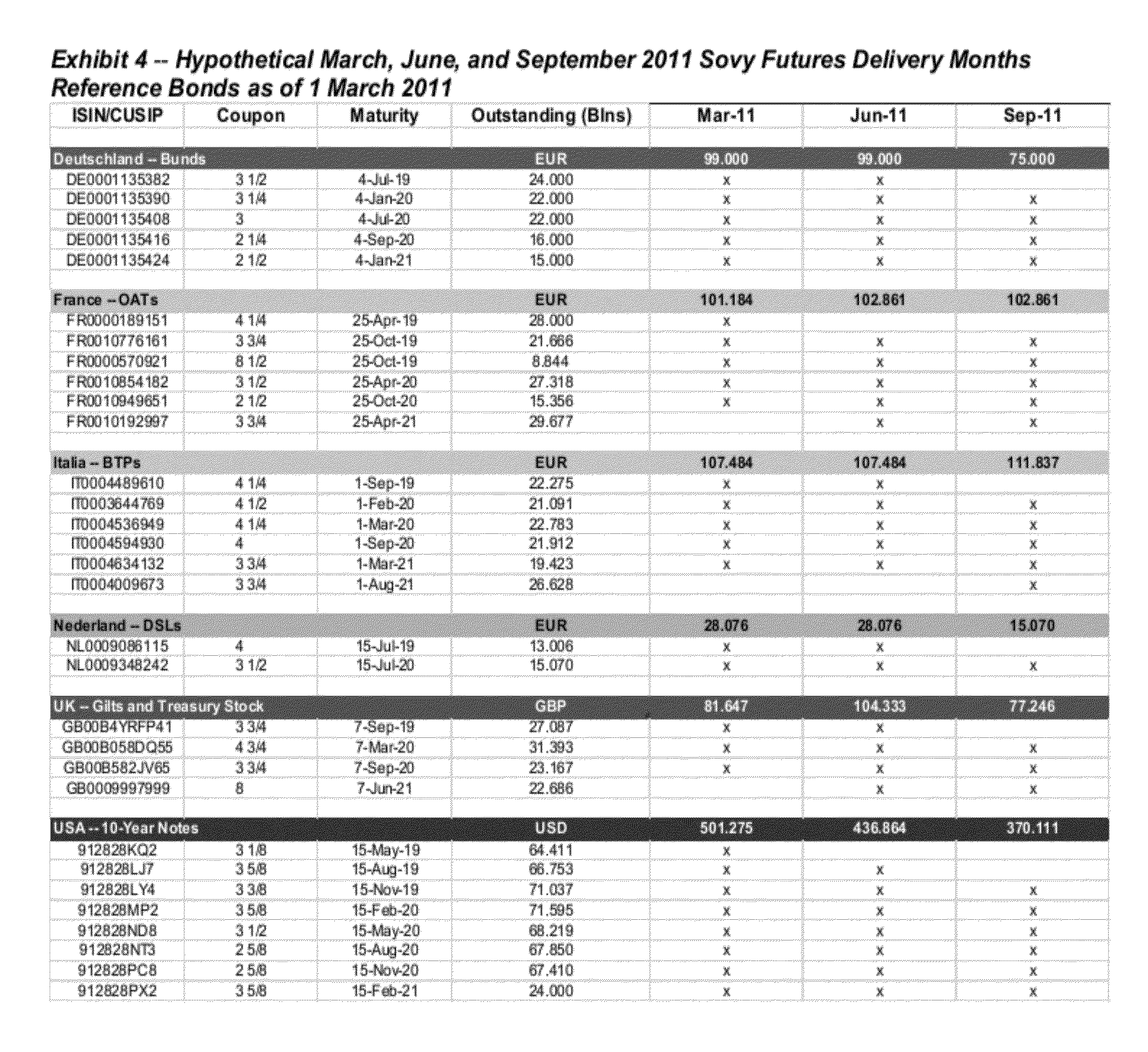

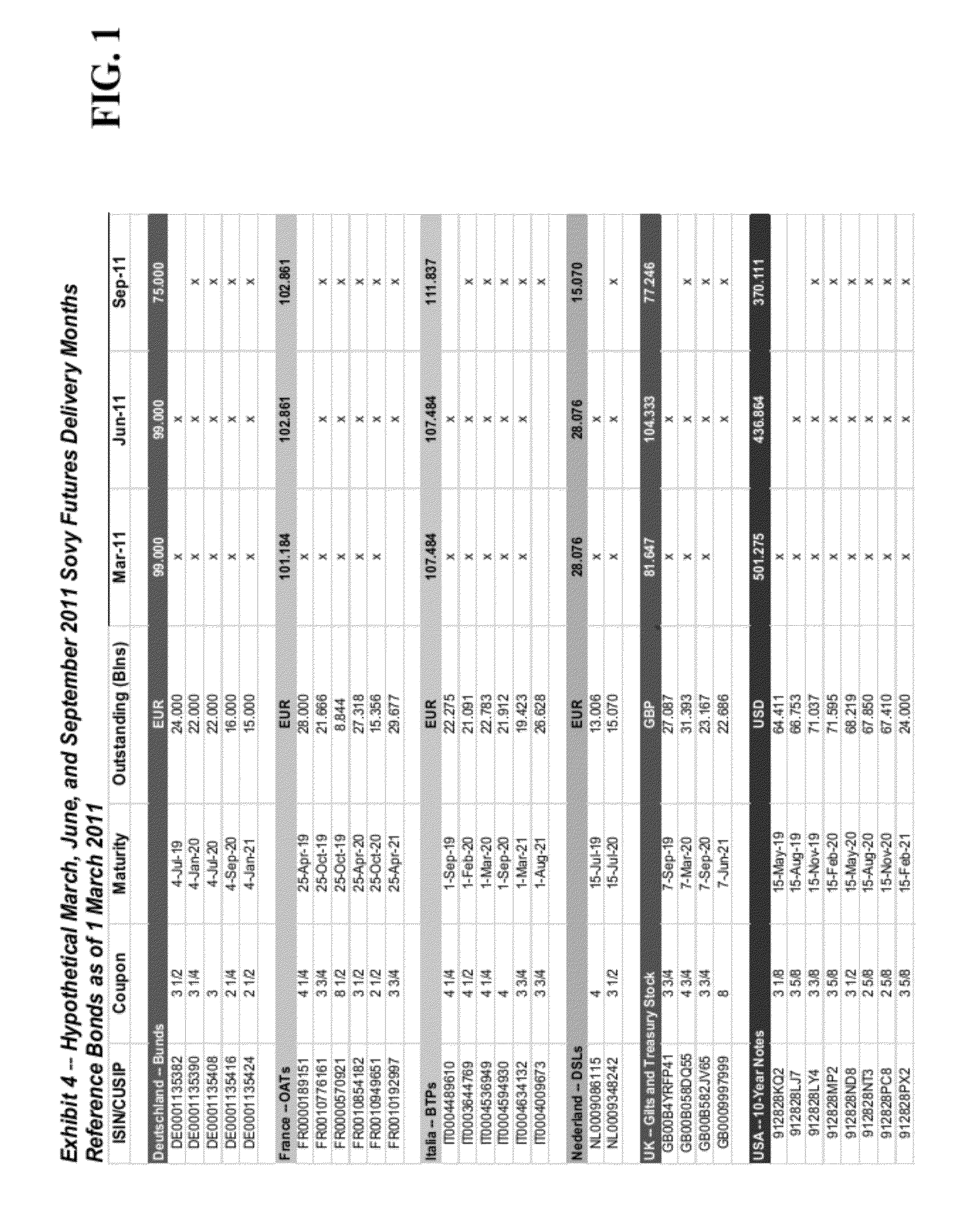

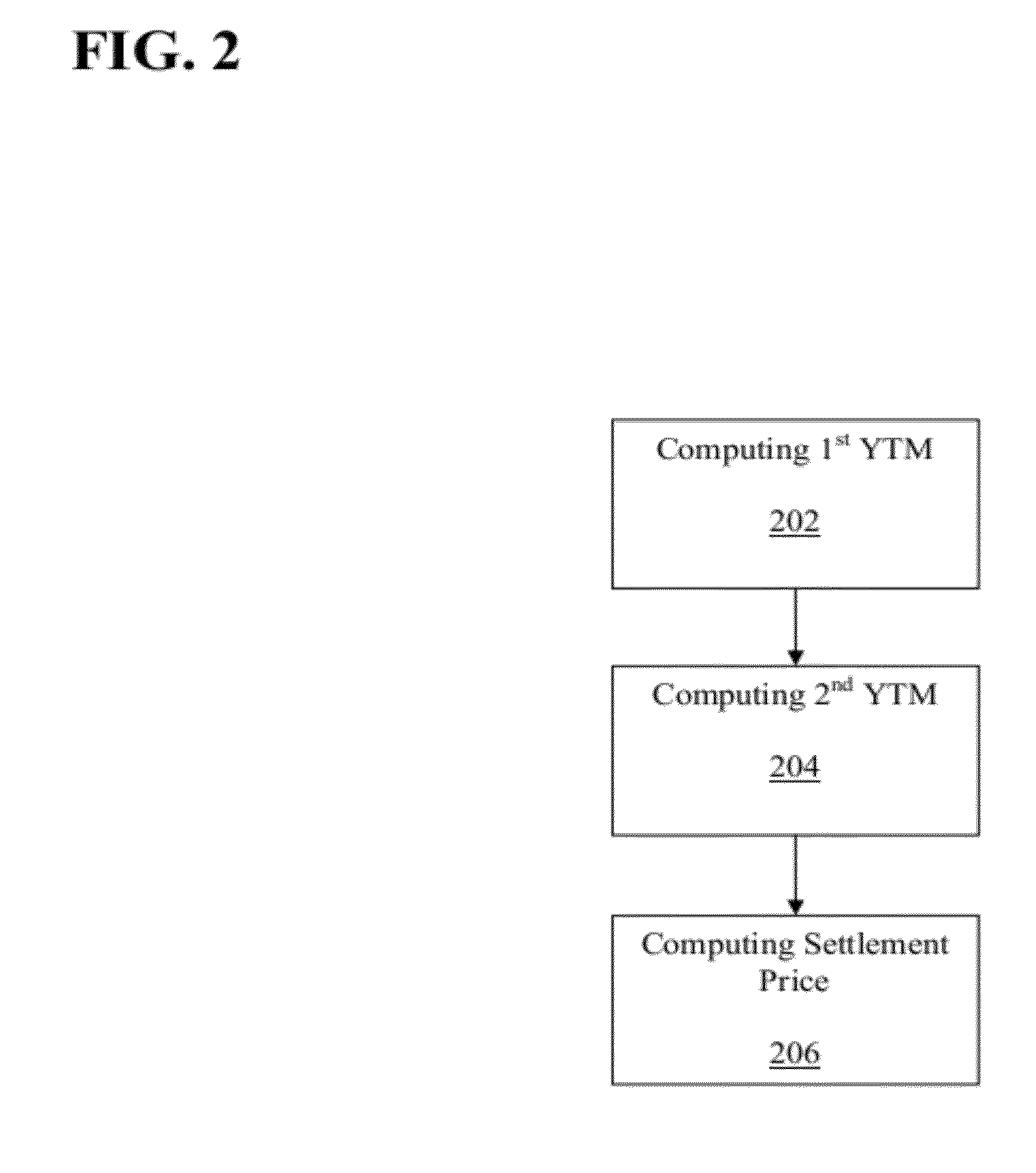

Fixed income instrument yield spread futures

A futures contract and method of computing a settlement price thereof are disclosed that enables a market participant to shed or acquire financial exposure in a conventional bond spread, in the form of single futures contract, rather than as a bona fide spread requiring active management of distinct long and short component bond positions, e.g. legs. The notional financial exposure of the futures contract is sized, not in terms of notional amounts / quantities of assets represented in the components of the futures contract's reference spread, but rather in terms of the pecuniary value of one basis point (i.e., 0.01 percent per annum) of the spread between yields to maturity for each of the components of the futures contract's reference spread. Effectively, the spread between the yields is defined inversely, i.e. the price per increment of spread is fixed whereas the quantities / notional amounts of reference bonds and the spread between them are not.

Owner:CHICAGO MERCANTILE EXCHANGE

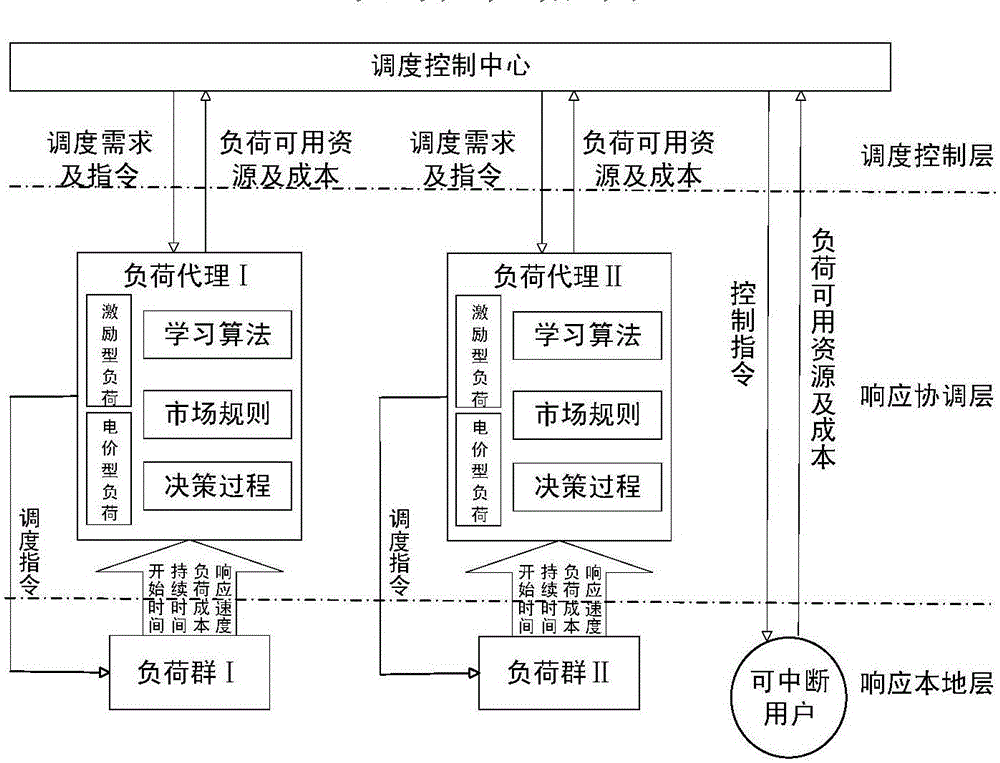

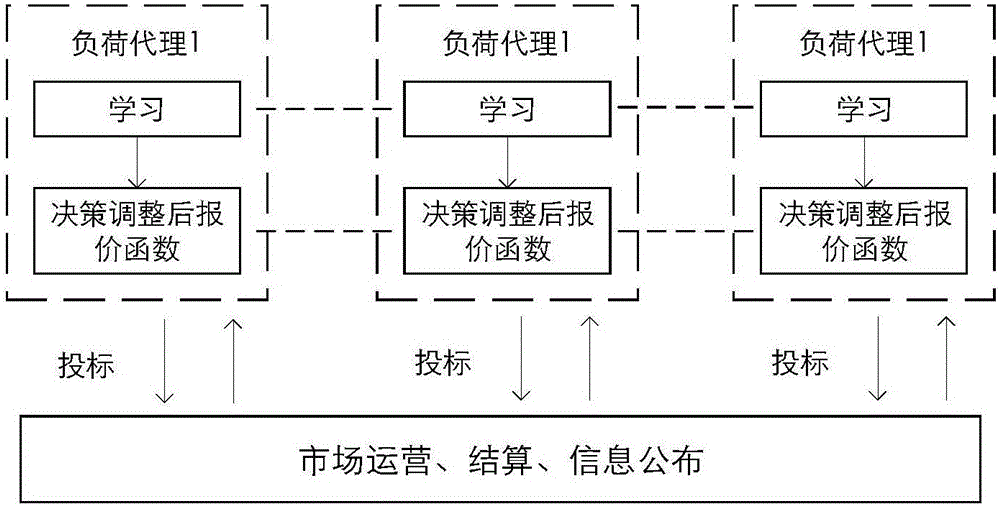

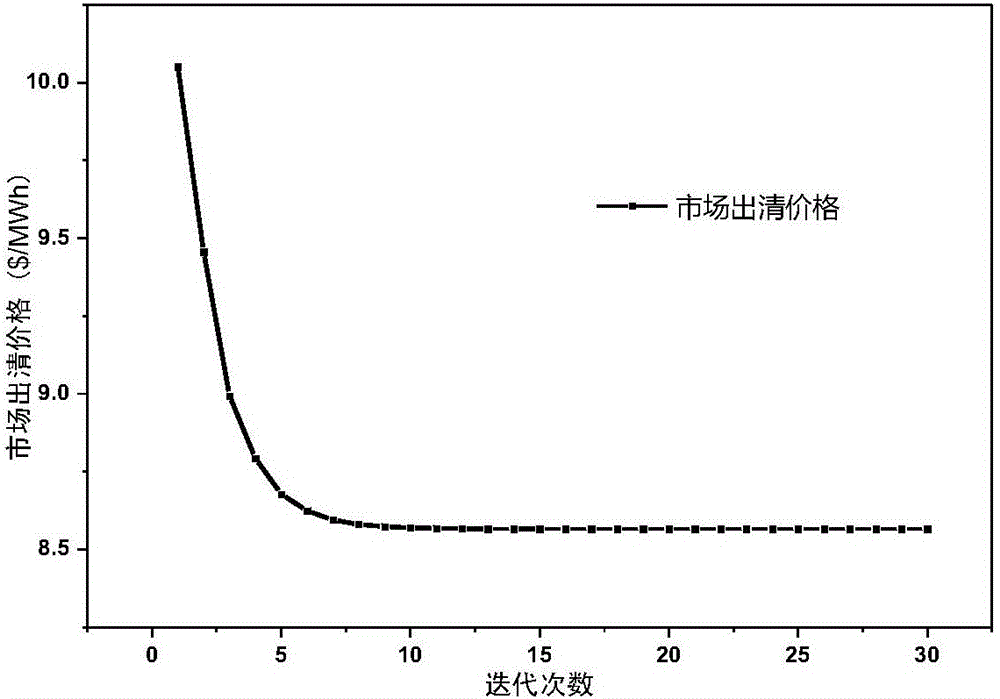

Simulation calculation method for Nash equilibrium point of electricity market including multiple load agents

The invention discloses a simulation calculation method for a Nash equilibrium point of an electricity market including multiple load agents. The electricity market is simulated based on a conjectured supply function equilibrium (CSFE) model, and profit of a load agent company comes from a result formed by subtracting the cost used by the load agents for scheduling electricity price type and excitation type load resources from a subsidy given by an electricity company after bid success. Based on features of electricity price type and excitation type loads, the cost of the load agents is a secondary function of output of the load agents, a bidding strategy limit compensation price is a primary function of the output, a bidding coefficient is determined by response conjecture variables of the agents for the market, the agents dynamically adjust their own bidding strategies through learning, after full competition, finally, the market reaches the Nash equilibrium point, an algorithm performs analog simulation on a bidding process of each time, the market gaming process when the multiple load agents appear in a specific market is fully represented, a clearing price of a market final balance state is obtained, and guidance is provided for construction of the electricity market and evaluation of resource utilization efficiency.

Owner:STATE GRID CORP OF CHINA +4

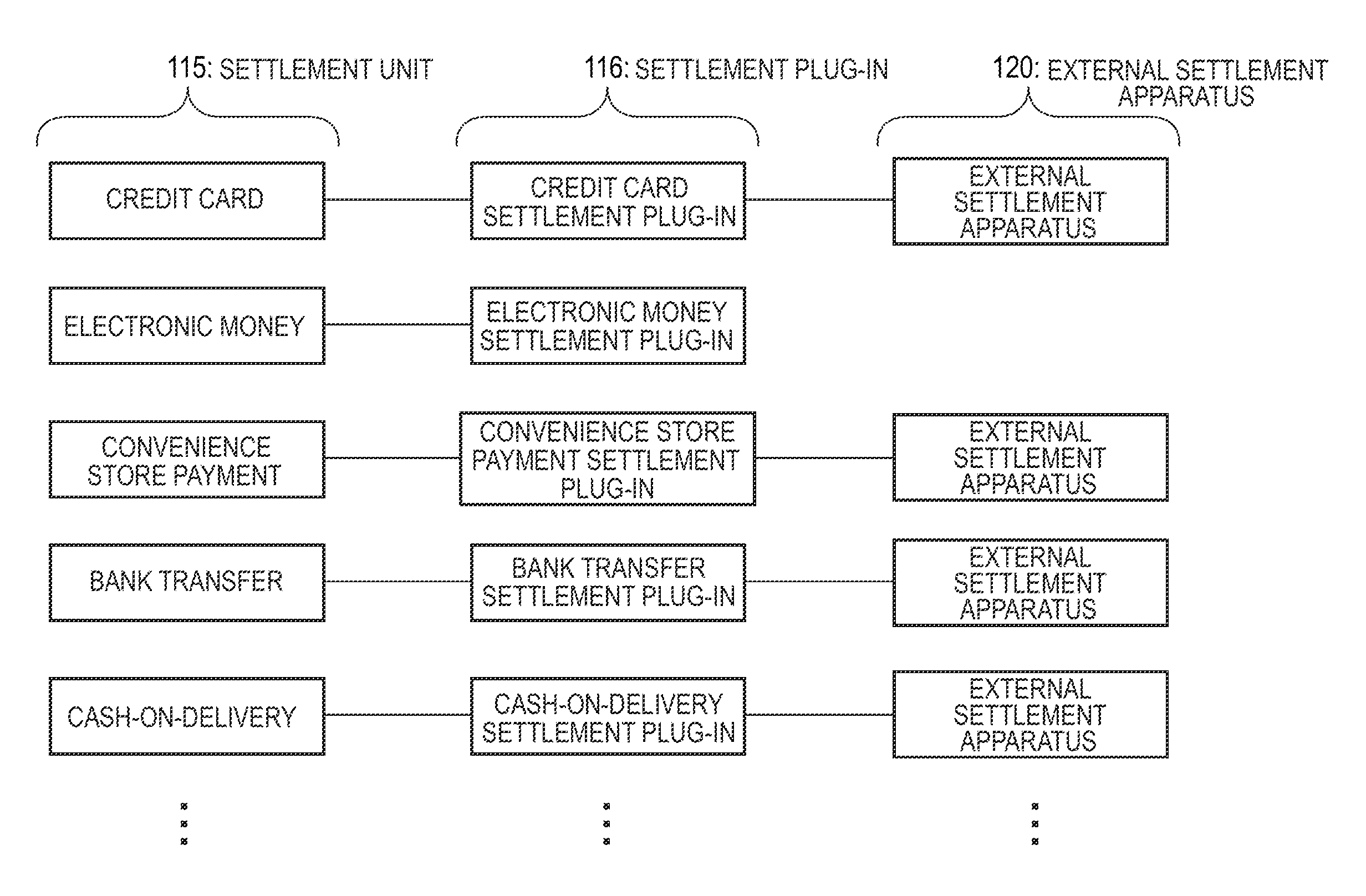

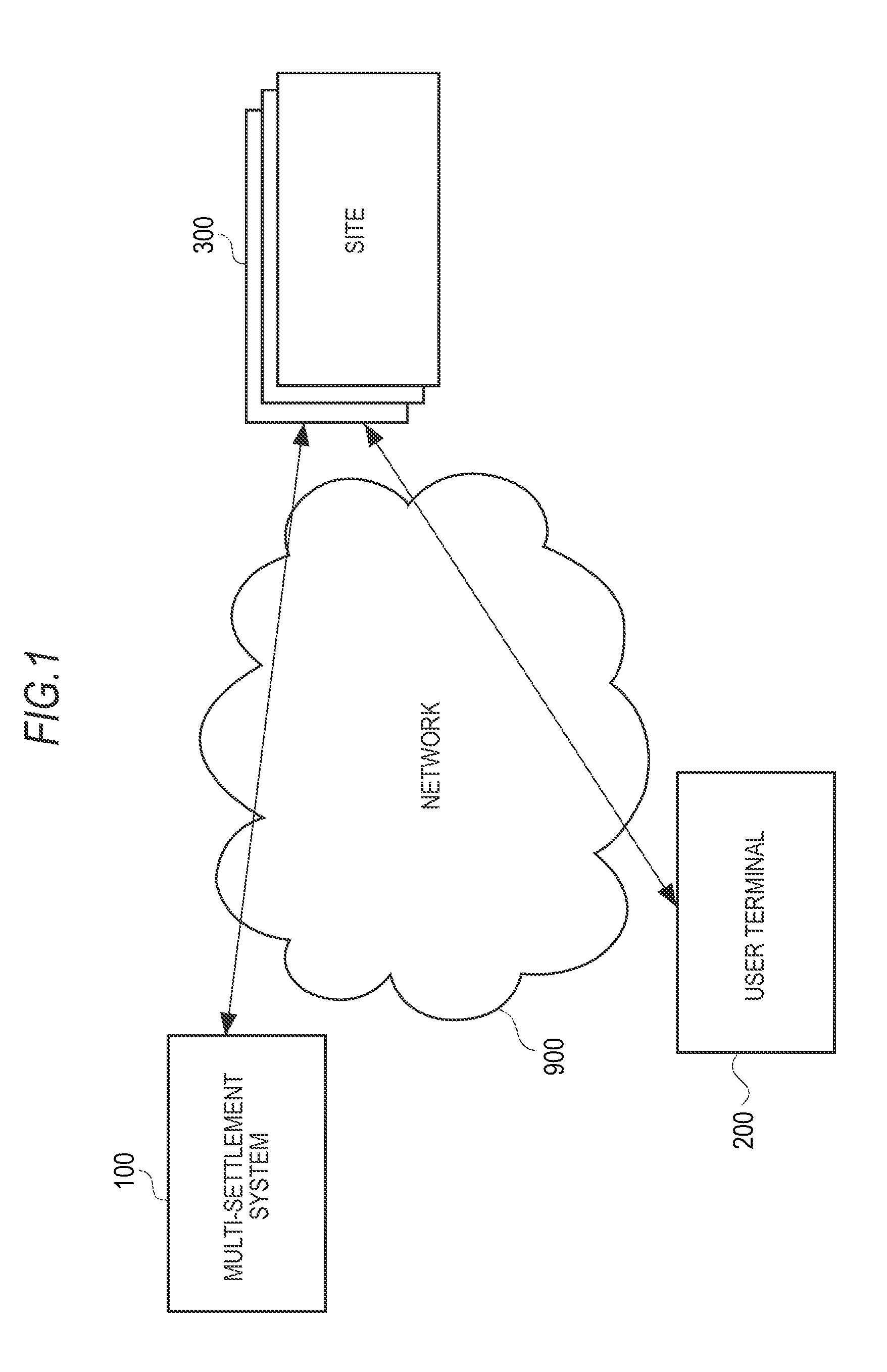

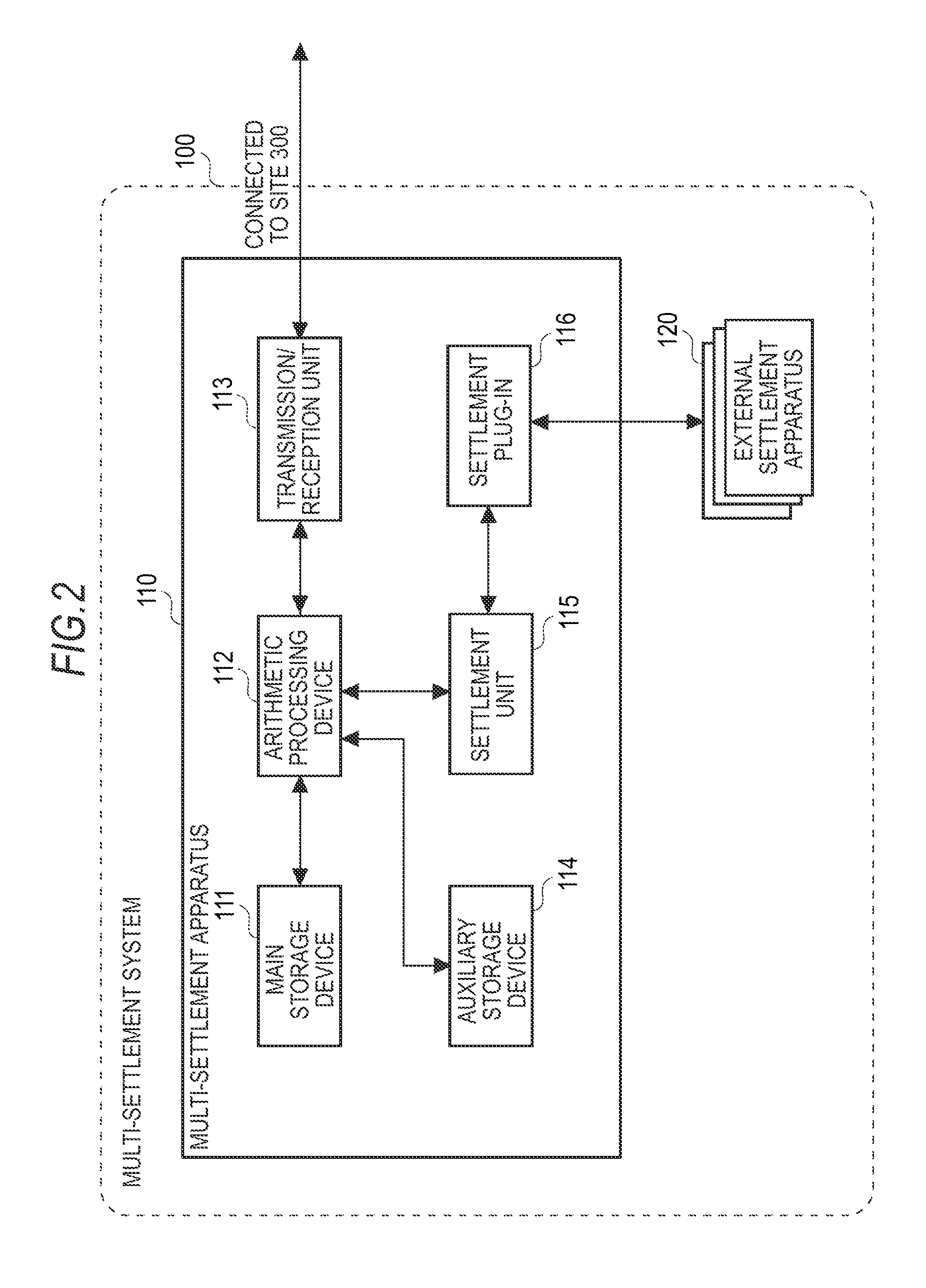

Method for performing multi-payment using multiple payment means, device for performing multi-payment, and program for performing multi-payment

One settlement is made with multiple settlement units. A user-selected settlement unit, at least one settlement price allocated to each settlement unit and a usage ratio allocated to each settlement unit, and a total price to be settled are received from a site. Credit processing is performed for each price obtained by allocating the total price to the settlement unit using the usage ratio or for each settlement price allocated to each settlement unit. Sales determination processing is performed for each price obtained by allocating the total price to the settlement unit using the usage ratio or for each settlement price allocated to each settlement unit. A message indicating settlement completion is transmitted to the site. In the first and second settlements, when all credit processing and sales determination processing can be performed within the multi-settlement apparatus, the processing is so performed, otherwise, an external unit is requested.

Owner:NEC CORP +1

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com