This is because exercising an option early forfeits the remaining time value of the option.

Also, exercising an option and converting it into the underlying property destroys the financial leverage that options enable.

In addition, incentive stock options usually have much longer terms than exchange traded stock options.

Calculation speed is critically important because market prices can change very quickly, and even the most advanced computers may have trouble calculating theoretical values fast enough to keep up with these changes.

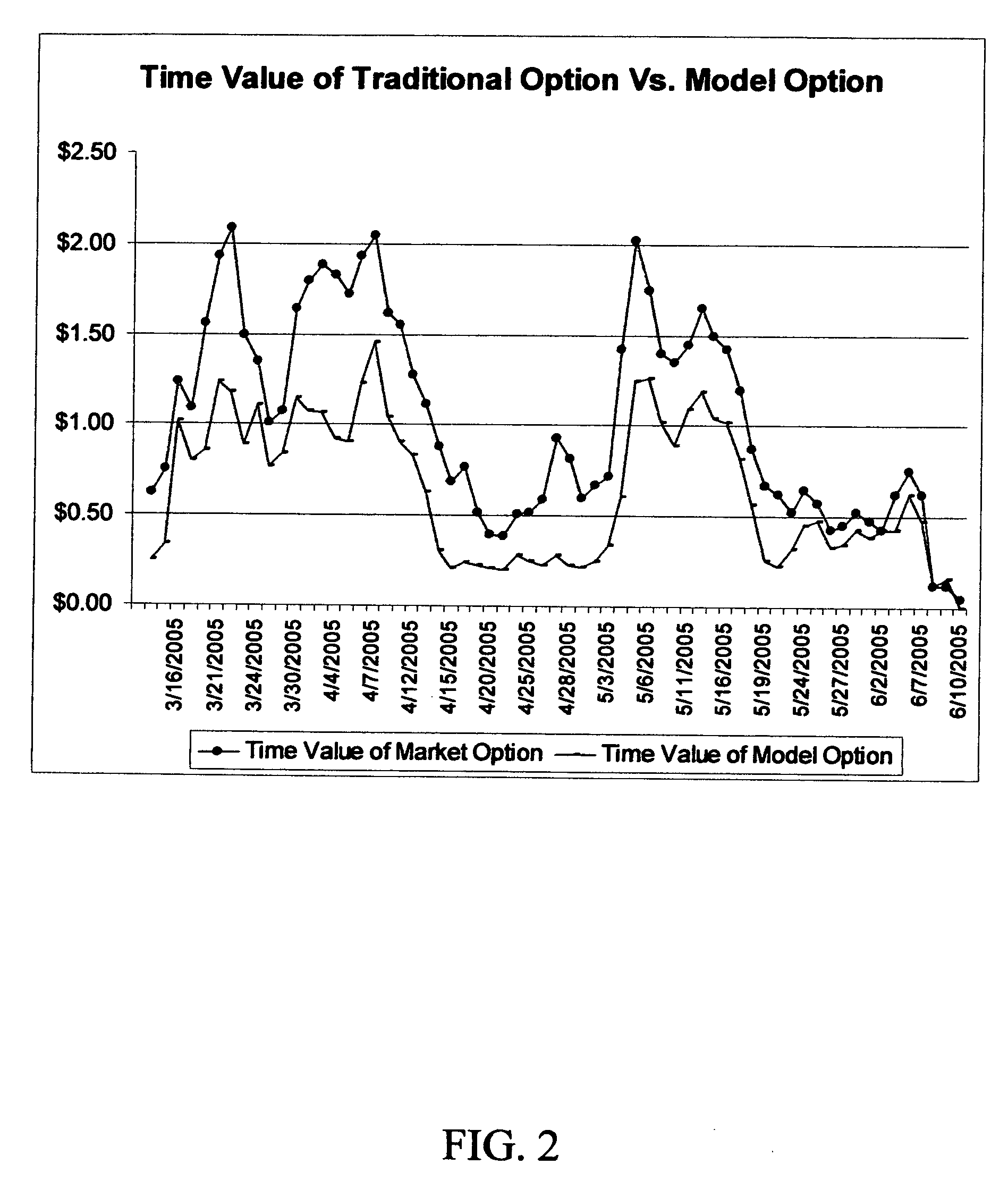

Despite new and improved option pricing models, there is still significant uncertainty about what the value of an option is.

Actual option prices may vary significantly from the theoretical values of the option pricing models due to a lack of liquidity.

Thin trading may impede price discovery and allow for greater pricing imperfections.

This may cause significant pricing distortions on options that do not trade very much such as options on smaller companies, option contracts with expiration dates greater than one year, and deep out-of-the-money contracts.

However there are significant differences between the model values and the market values even when options are heavily traded.

While the risk-free interest rate and the dividend rate may change, these values do not generally change enough over short-periods of time to cause big changes in option values.

Thus, the parameter most in dispute is the volatility of the underlying stock.

However, this number is not very meaningful for deep in or out-of-the-money options, where extraordinary amounts of volatility are required to change the option value by relatively small amounts of money.

First, option calculations are relatively complicated and difficult for the average investor to understand.

The

learning curve is steep for most investors, and the details of option usage are difficult to explain to the uninitiated.

This lack of understanding makes many investors uncomfortable with using options.

Second, since most options are traded on exchanges, option prices are subject to market distortions which may prevent even the most astute observers from being able to use them effectively.

While there is significant trading of stock options at or near-the-money for the largest companies, there may be little or no trading of deep out-of-the-money options on those stocks.

Moreover, there is not much liquidity for options that extend beyond one year or for options on the stocks of smaller companies either.

Third, although

theoretical models of option valuation may help provide some insight into the pricing of options, they are also problematic.

Despite all of the advances, there are still significant differences between the model prices and the market prices of options.

Such differences are confusing to investors.

Forth, since there is not much of a market for long-duration options such as incentive stock options, one cannot compare the model valuations to the market valuations for such options.

Thus, one cannot even demonstrate that the models work as well in such situations as they do on contracts with lesser expiration dates.

This is problematic given that current accounting treatment requires companies to ascribe a fair value to incentive stock options.

Meanwhile employees may not attribute much or any value to the options that they are granted because they have may not have fully vested, typically have no intrinsic value, and cannot be sold.

Moreover, most employees have no understanding of option valuation models.

Fifth, the trading cost of using options can impair the use of deep out-of-the-money options.

This is because the expense of trading such options gets too large in relation to the expected value of such options.

Ultimately option usage is curtailed because people do not understand how they work and they are suspicious that the price of options may be incorrect, regardless of whether it is derived from an option pricing models or the market.

In effect, the degree of moneyness, company size characteristics, and near-term expiration dates all limit the potential size of the options market and in turn limit its usefulness to investors.

To a large extent this “valuation gap” is caused by the holder's inability to see a ready market price at which someone will buy the option from them so they tend to ignore the time value of the options granted.

The current market-based approach to option pricing discourages trading of such options because the fees are static and participants would have to pay trading fees that are too large in relation to what the underlying options are worth to be economical.

Currently, options exchanges are not interested in such trading because it does not represent a significant amount of transaction volume, and the cost of such activity is not worth their trouble.

Conversely, market participants generally steer away from such trading due to fears of pricing distortions and the potential for manipulation.

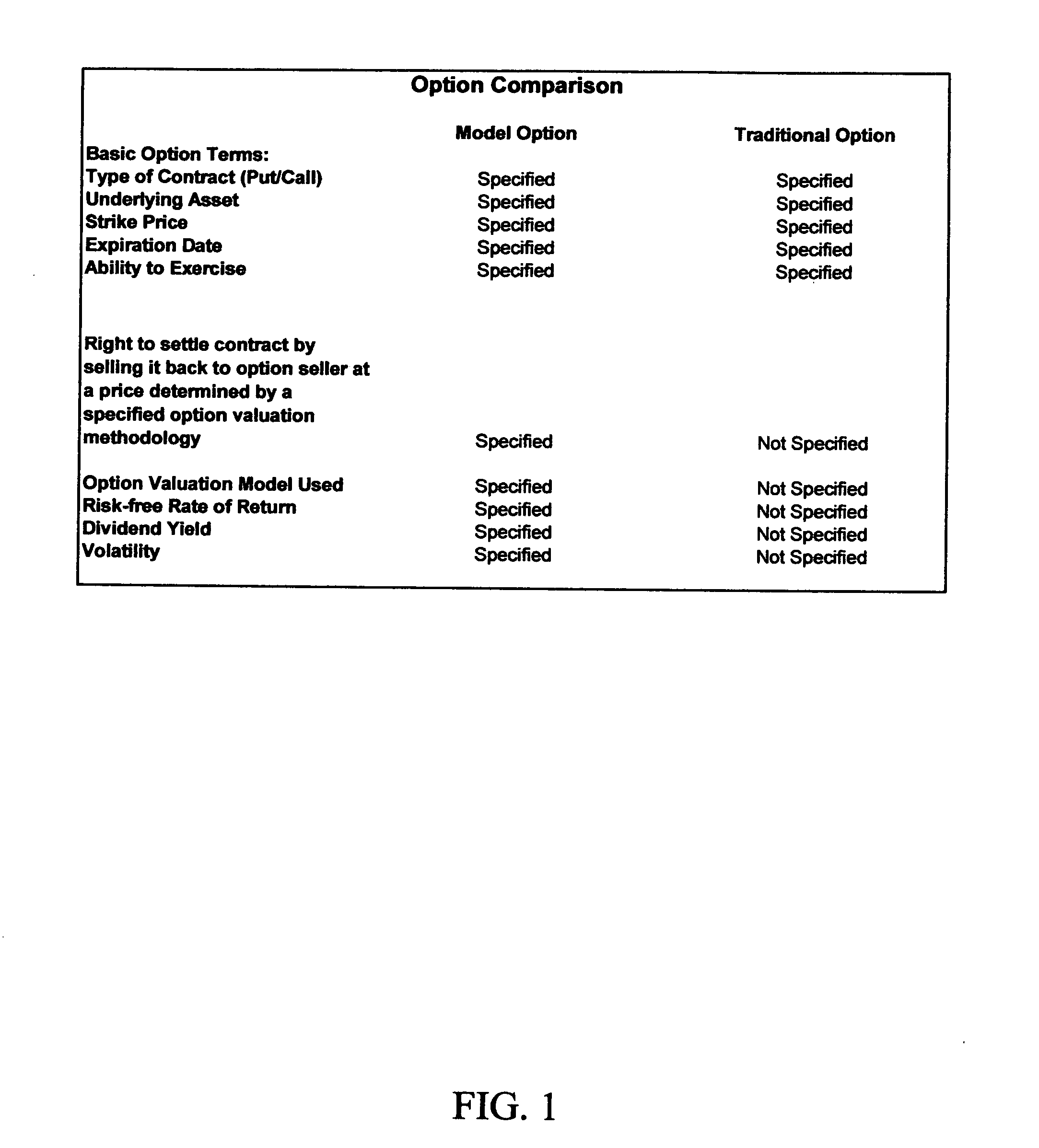

Unlike traditional options, Model Option Contracts can be structured so that they do not allow the holder to force delivery of the underlying asset.

Login to View More

Login to View More  Login to View More

Login to View More