Patents

Literature

953results about How to "Efficiently determined" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Method for utilizing temperature to determine a battery state

InactiveUS7348763B1Effective conditioningEfficiently determinedBatteries circuit arrangementsElectrical testingCharge and dischargeEmpirical data

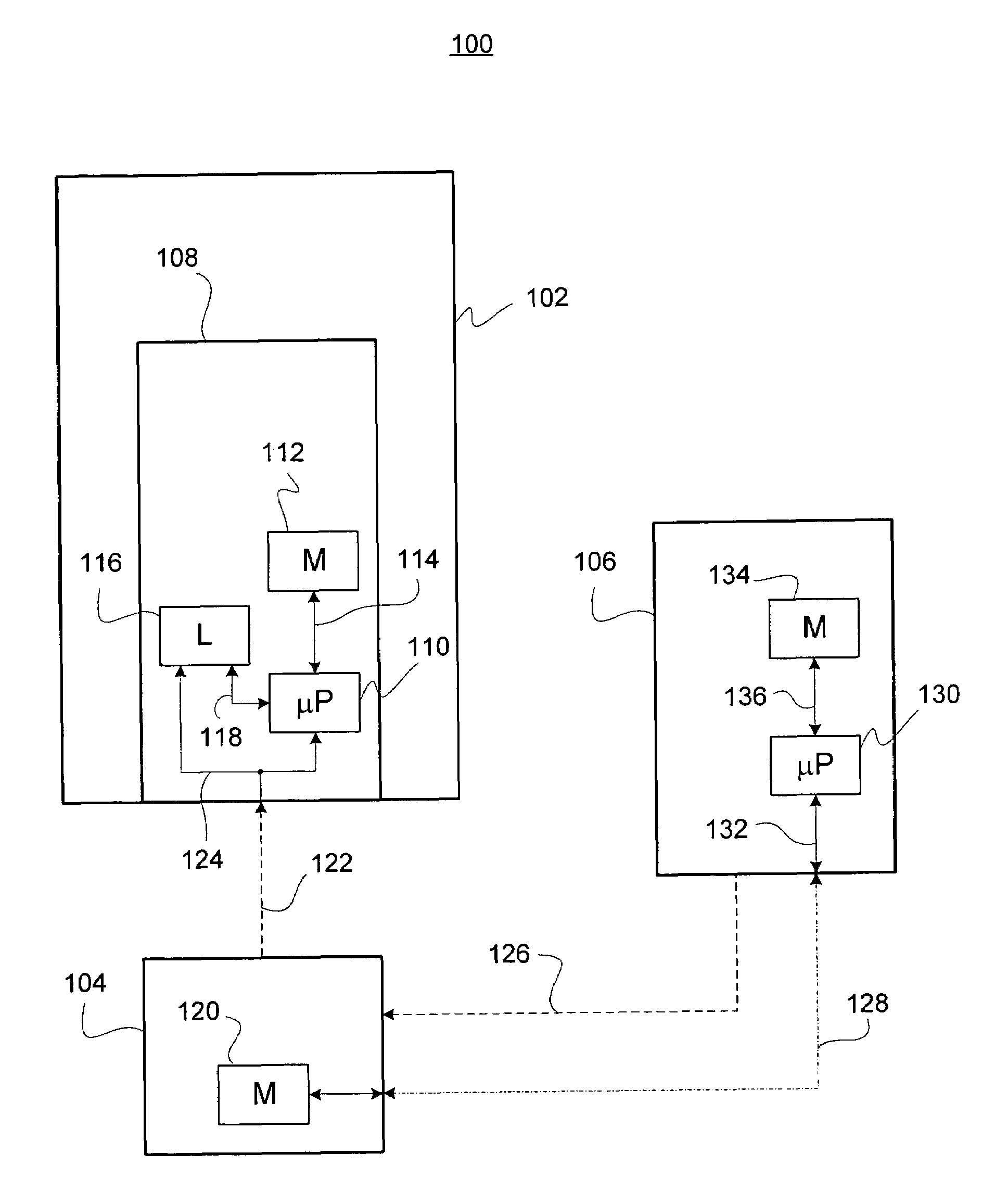

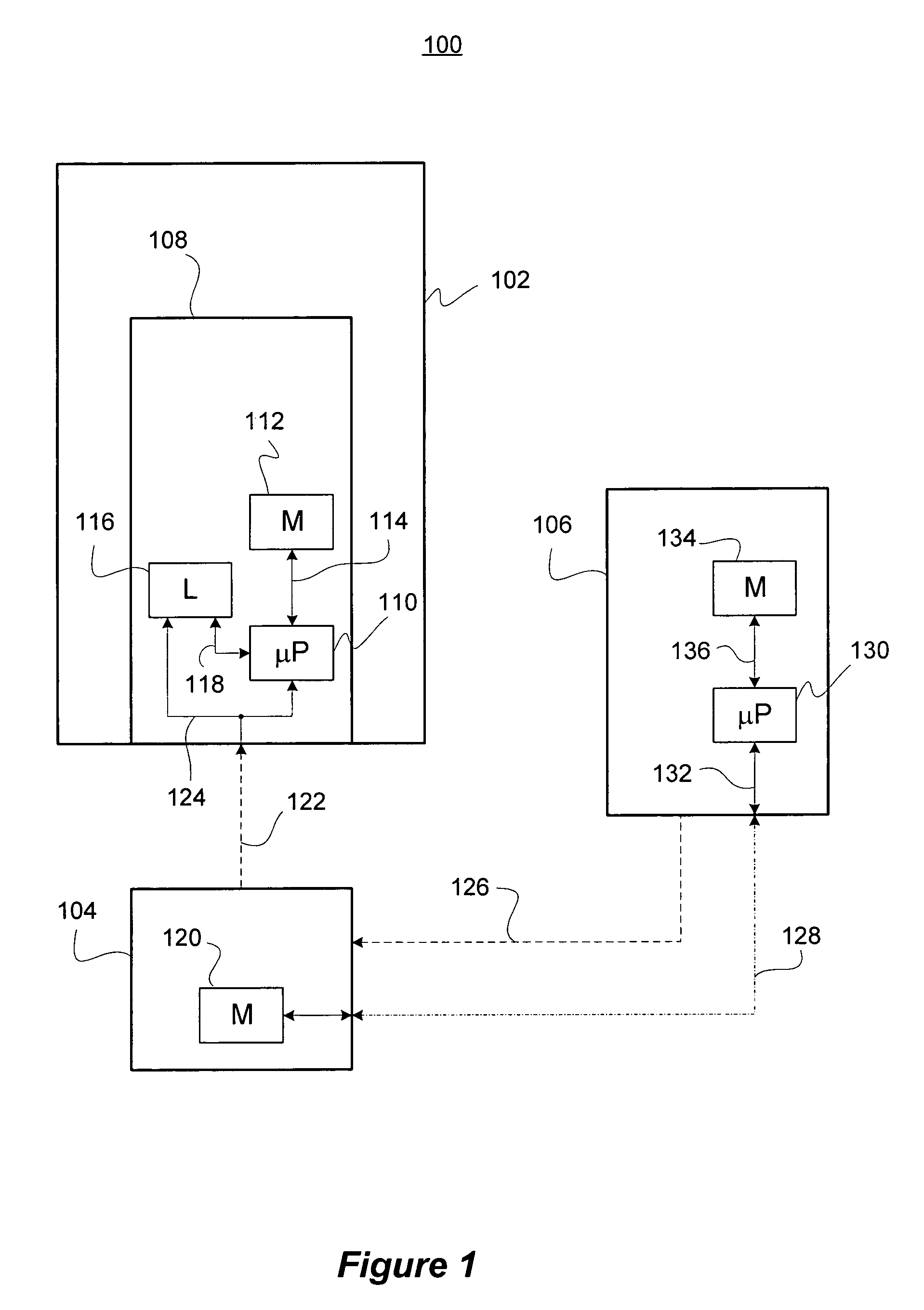

A method for determining the state of a battery, or battery pack, that is independent of the type of battery technology under test. The method employs one or more charging and discharging cycles, and measures one or more parameters of battery voltage, temperature, charging time, and charging cycle counts to produce a test value that is compared to empirical data. Based on the comparison, the state is determined, for example, on a pass / fail basis. The method may be embodied as instructions stored in memory and implemented by means of a microprocessor coupled to the memory. In another embodiment, the empirical data is stored within another memory located internal to the battery pack under test.

Owner:LINVATEC

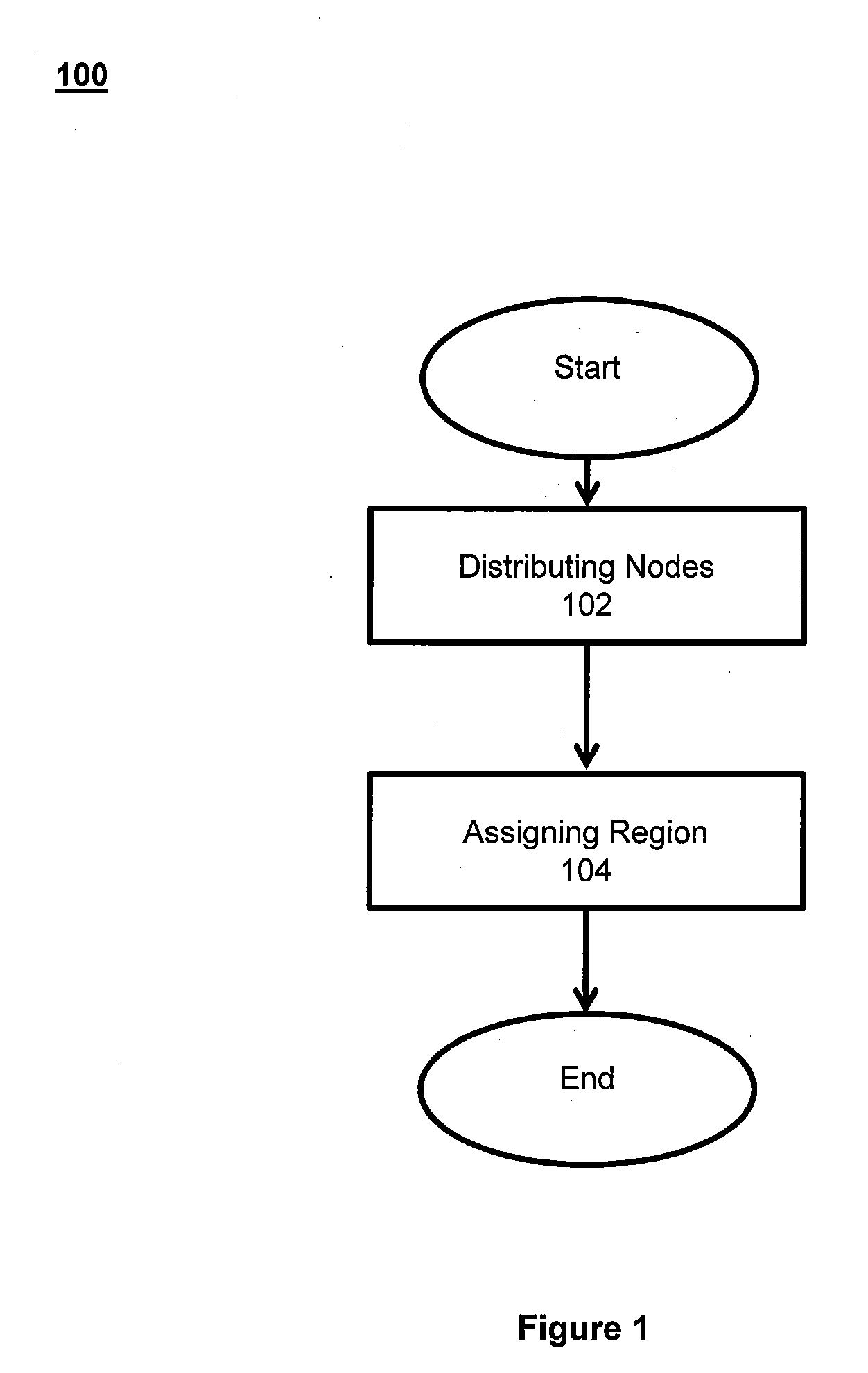

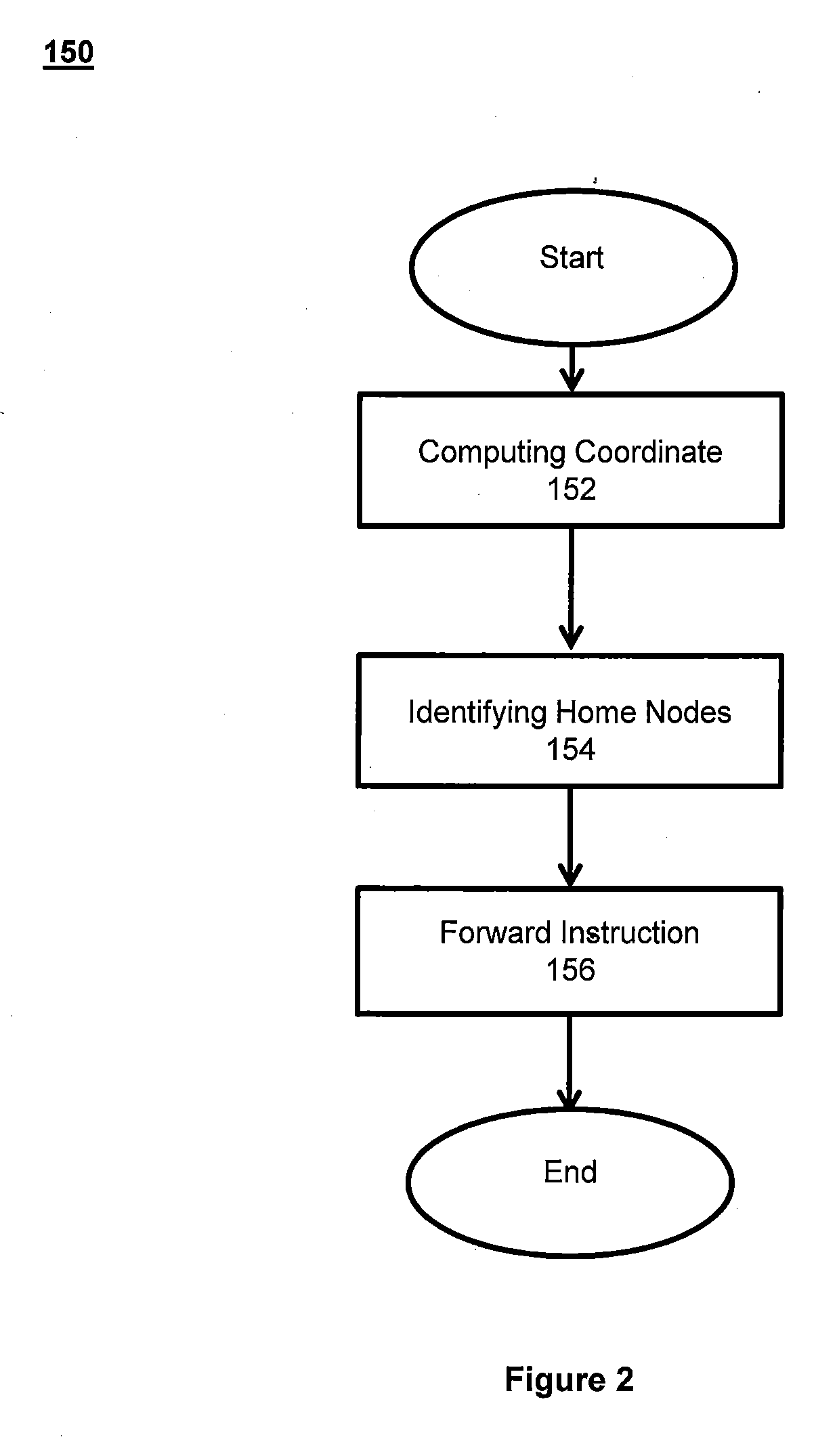

System and methods for mapping and searching objects in multidimensional space

ActiveUS20130138646A1Reduce in quantitySpeed up searchWeb data indexingDigital data processing detailsData miningMultidimensional space

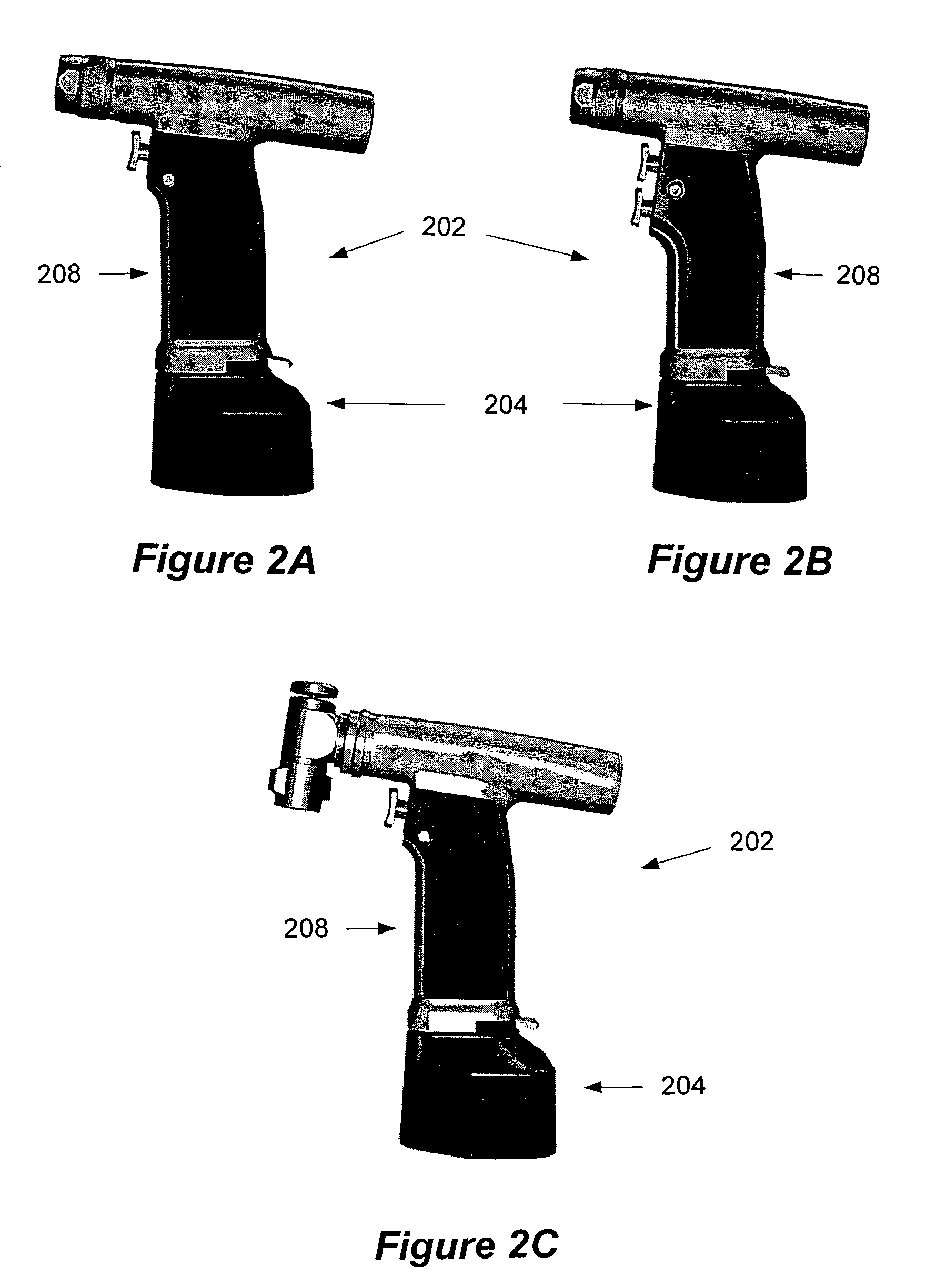

This invention relates to a system and methods for determining the placement of an object in a distributed key-value store by mapping the object to nodes in multidimensional hyperspace. A search function supports efficient object retrieval, even when the search query requests multiple objects and specifies them through non-primary keys. In response to a search query, the search is translated into hyperregions in the hyperspace to determine the set of nodes that hold the queried data object. The number of contacted nodes and the number of scanned objects are significantly reduced in comparison to prior art techniques.

Owner:CORNELL UNIVERSITY

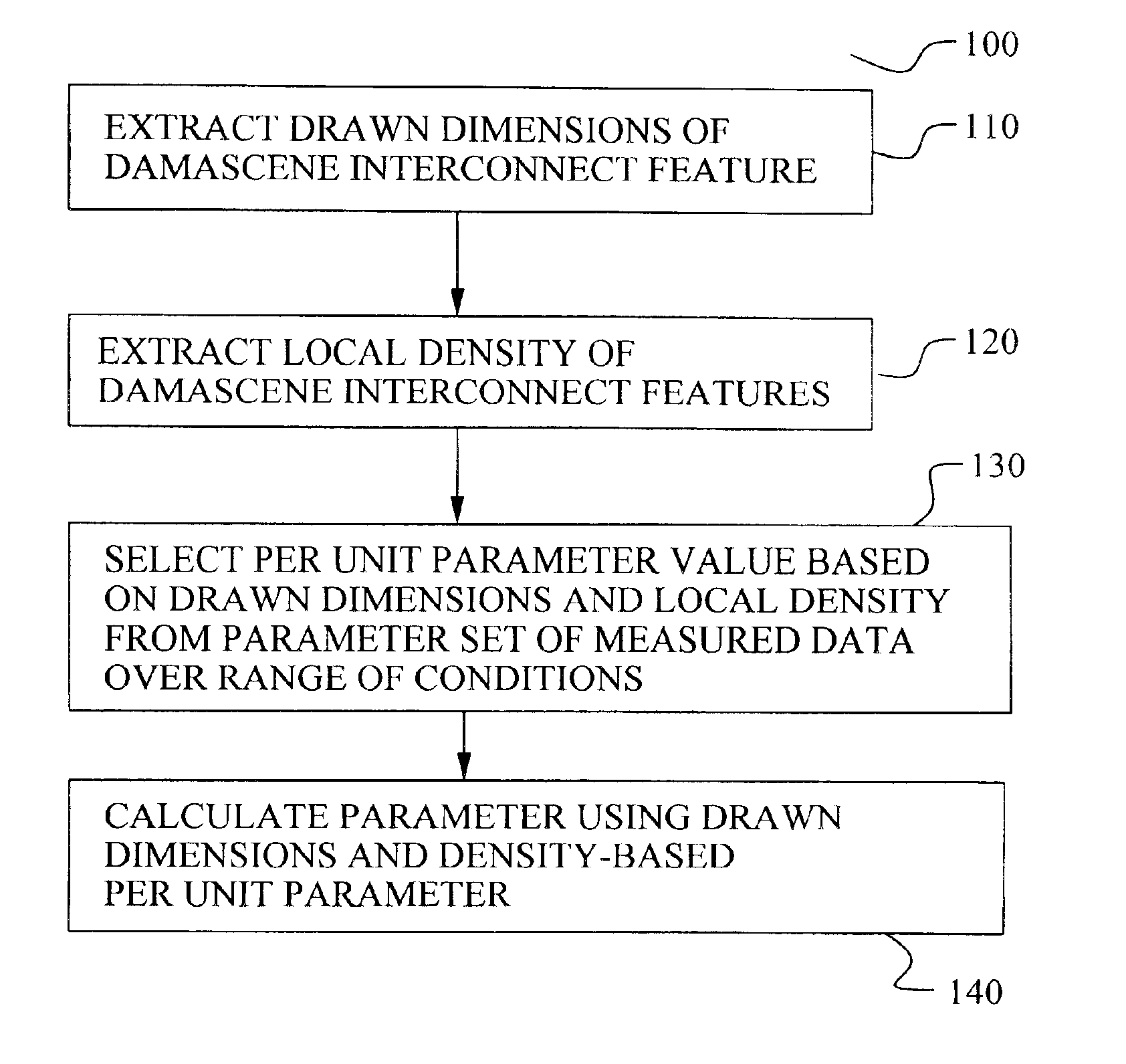

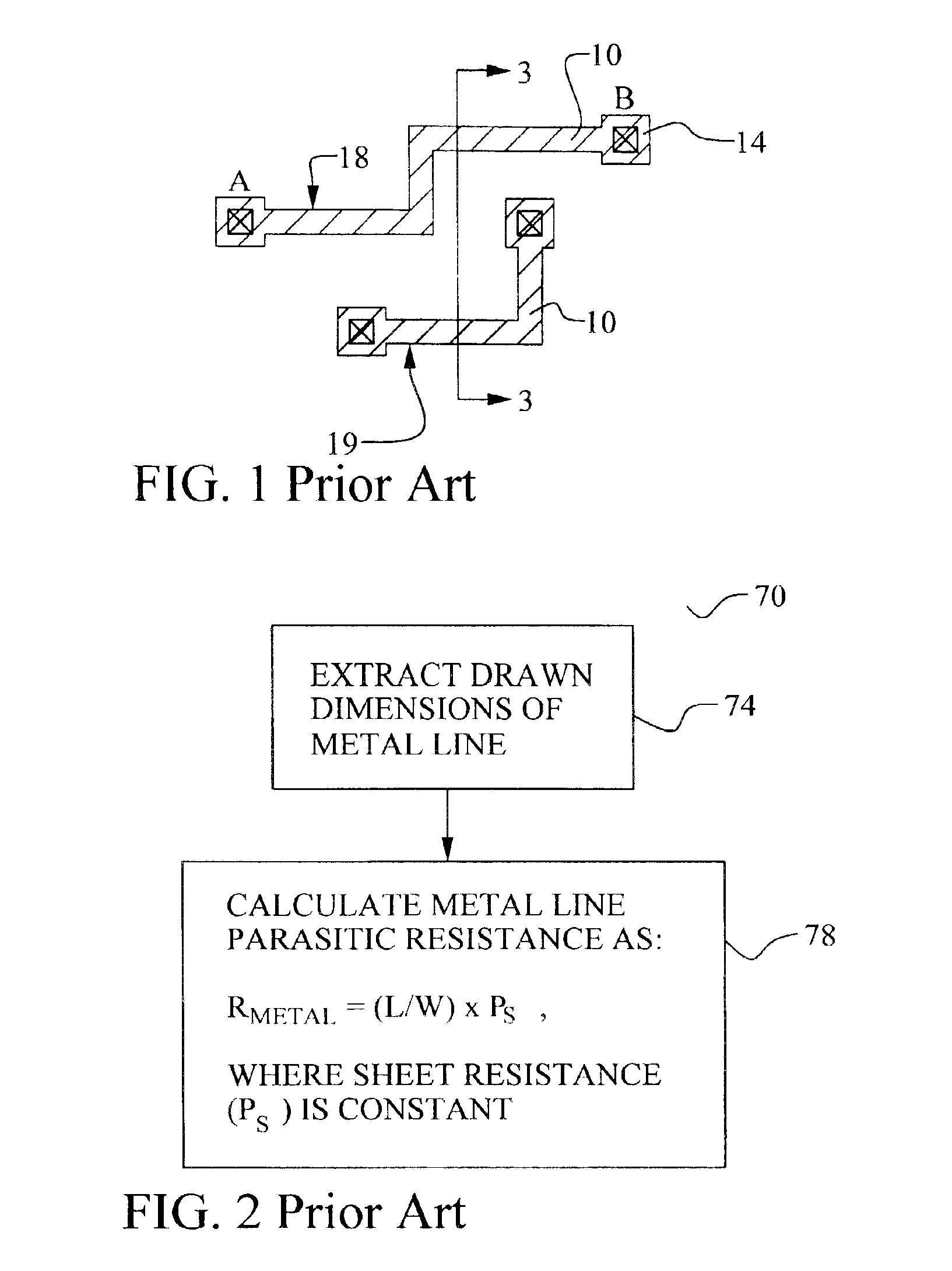

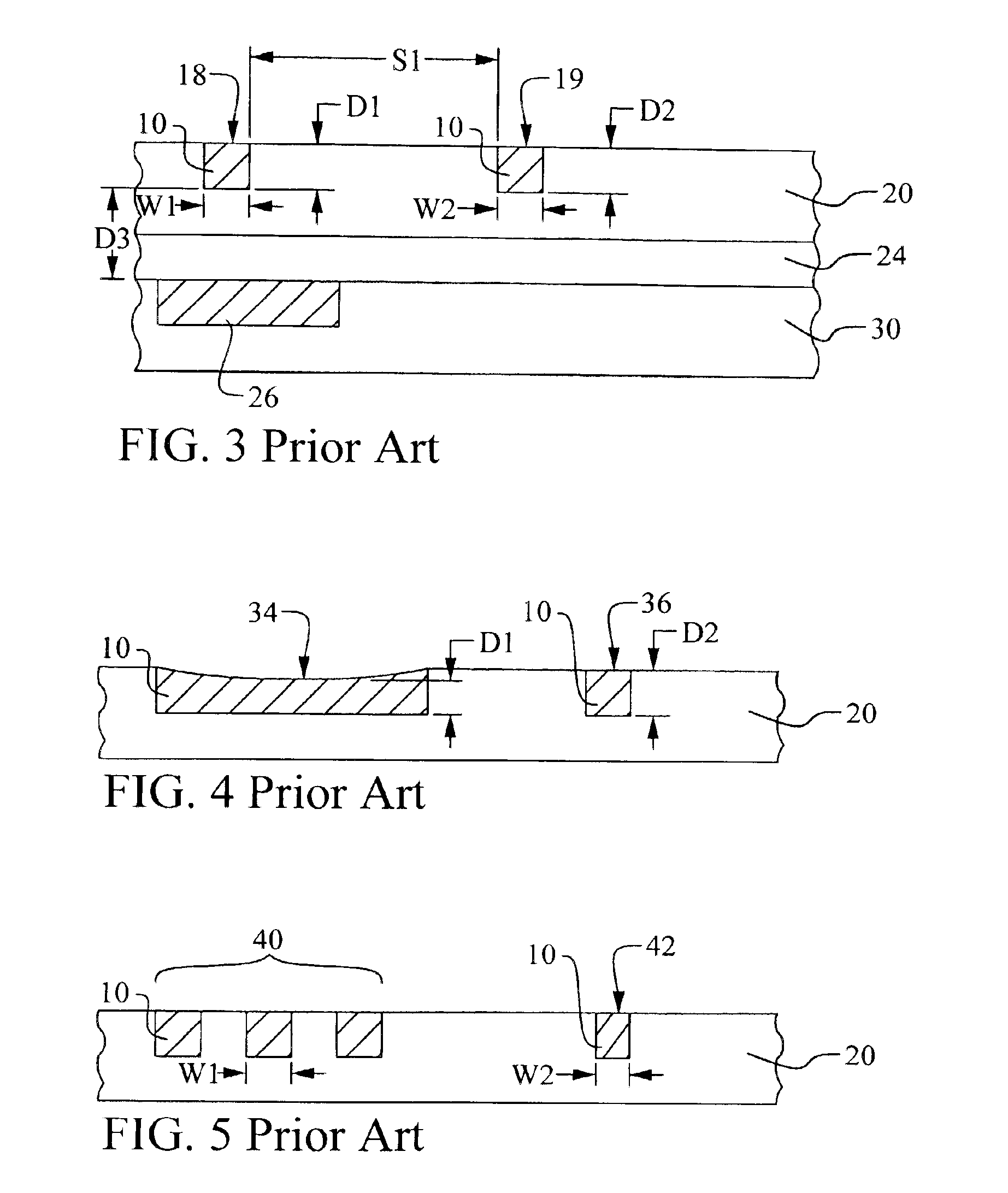

Methodology to characterize metal sheet resistance of copper damascene process

InactiveUS6854100B1Efficiently determinedSemiconductor/solid-state device testing/measurementDetecting faulty computer hardwareCopper damasceneIntegrated circuit

A new method to determine a parameter of a damascene interconnect in an integrated circuit device is achieved. Drawn dimensions and local pattern density of a damascene interconnect are extracted in an integrated circuit device. A parameter of the damascene interconnect is calculating using the drawn dimensions and the local pattern density to select a per unit value from a set of per unit values measured over a range of drawn dimension and pattern density combinations. The method may be used to improve the accuracy of extracted damascene metal line resistance and parasitic capacitance.

Owner:TAIWAN SEMICON MFG CO LTD

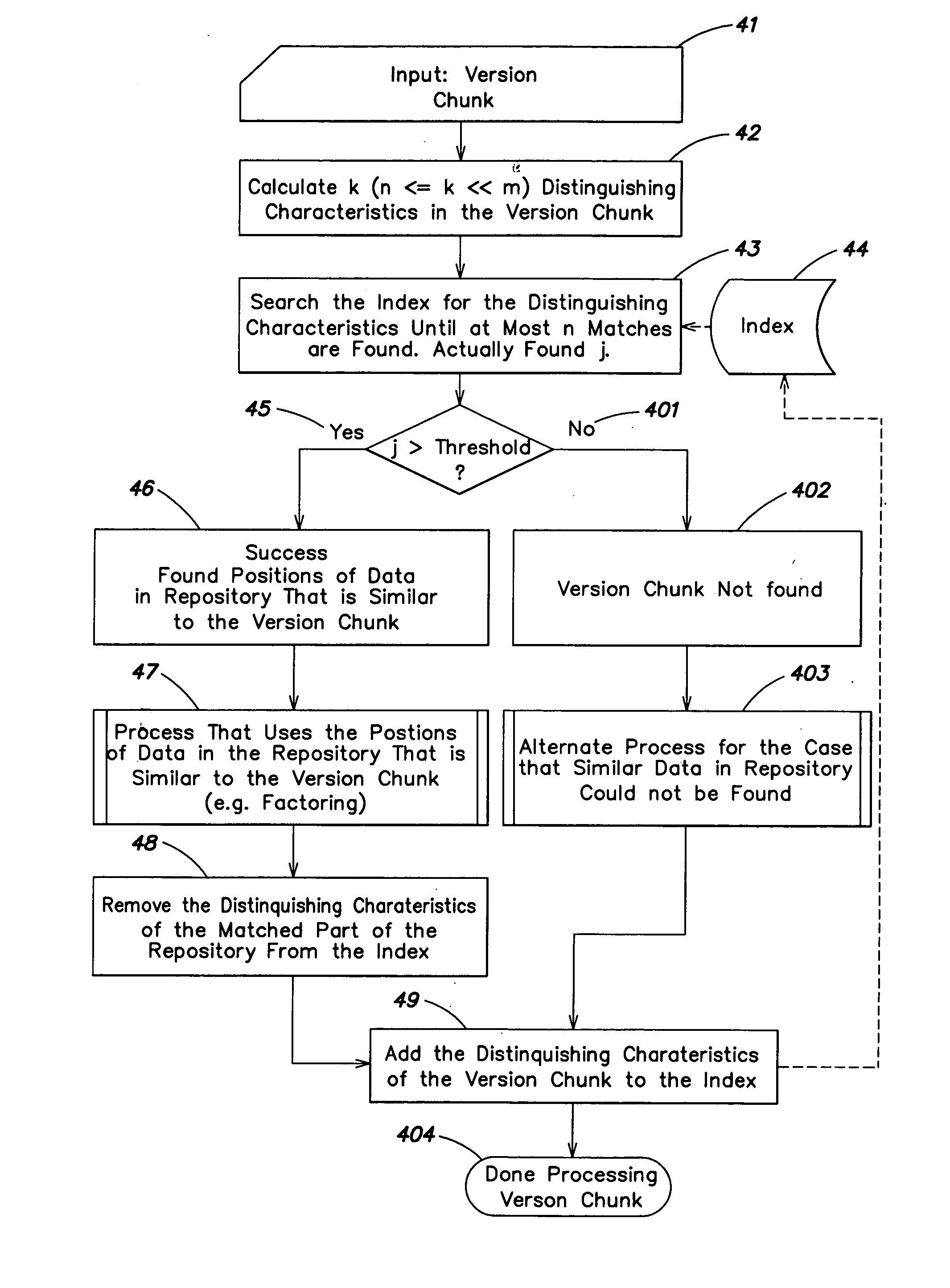

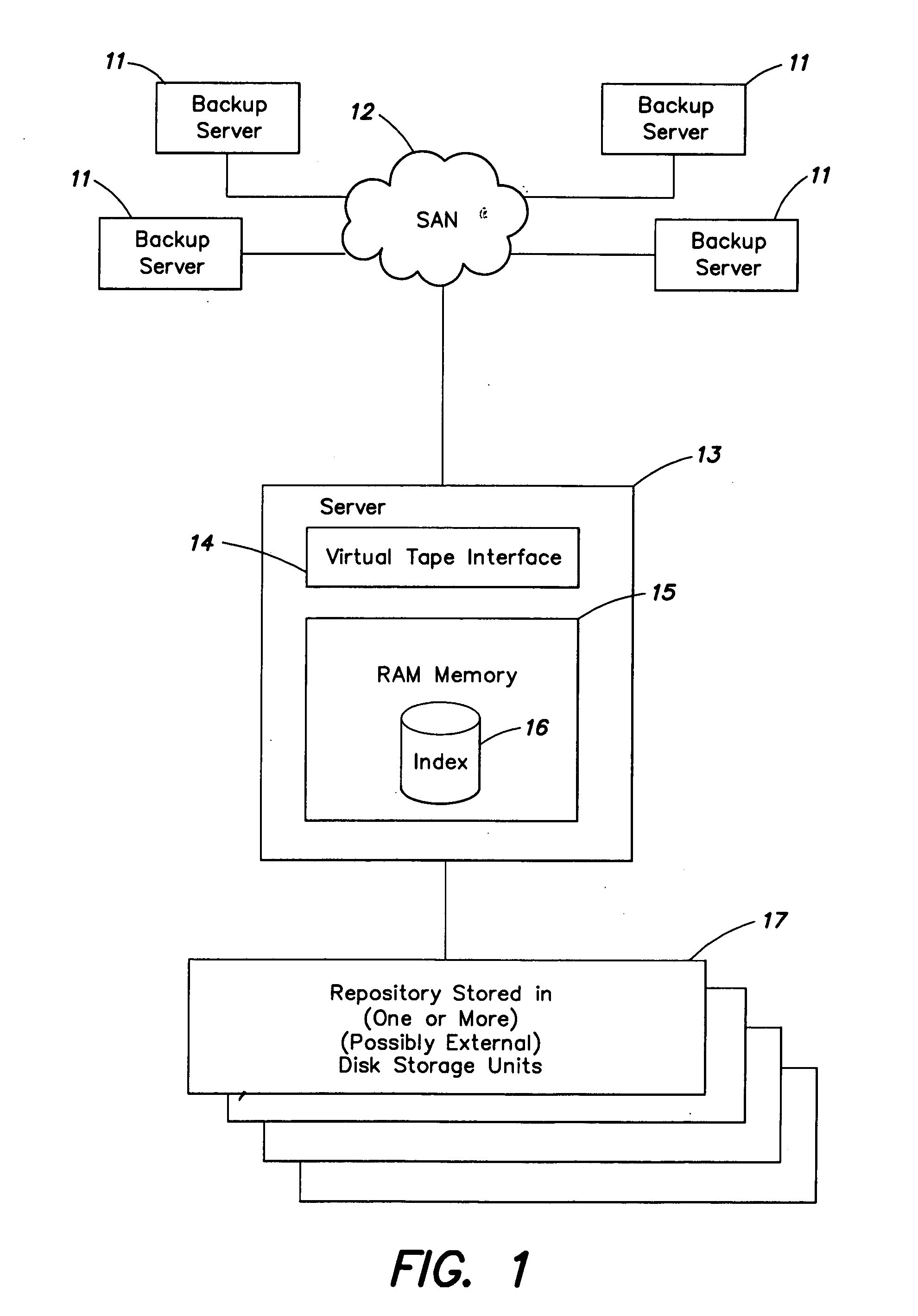

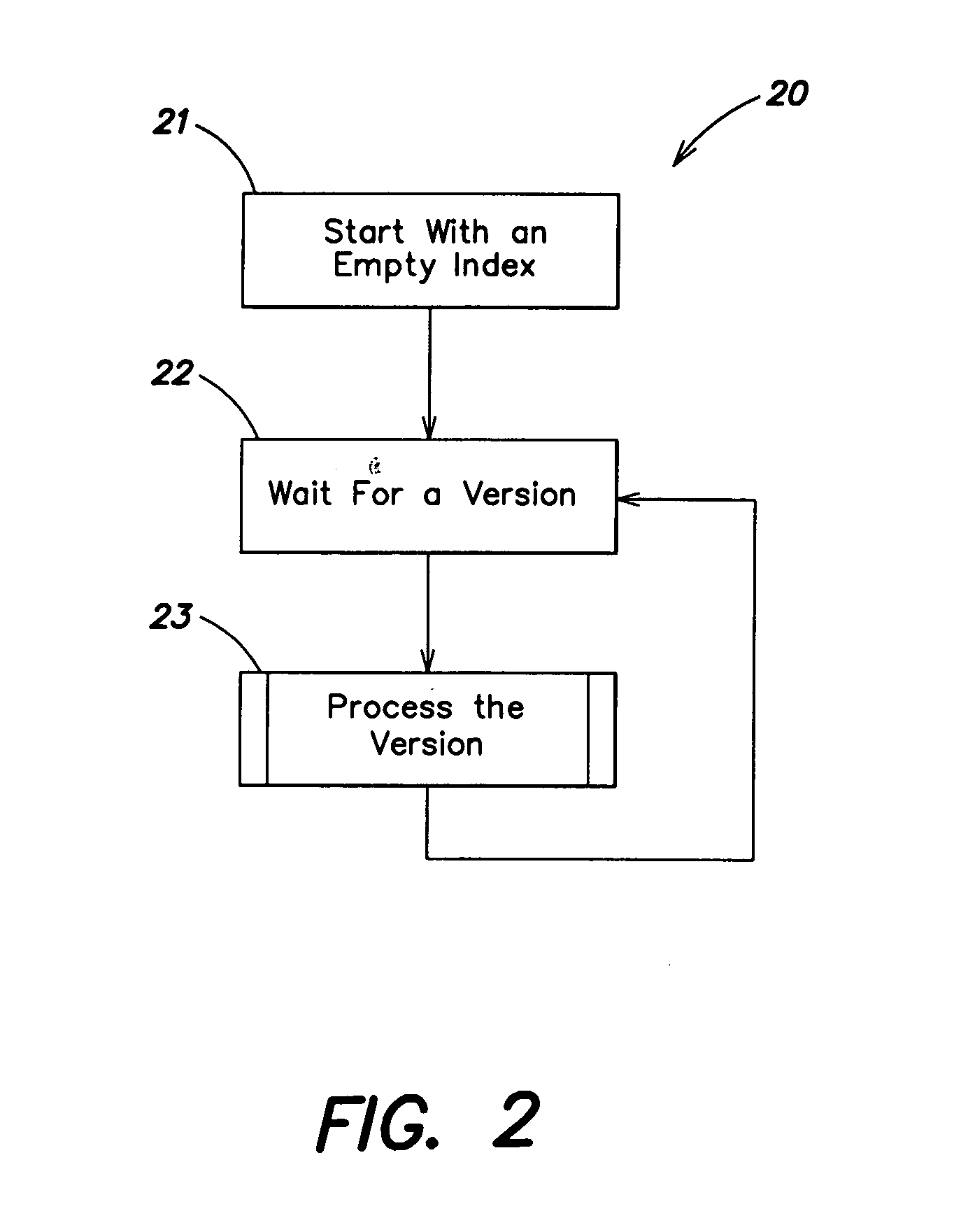

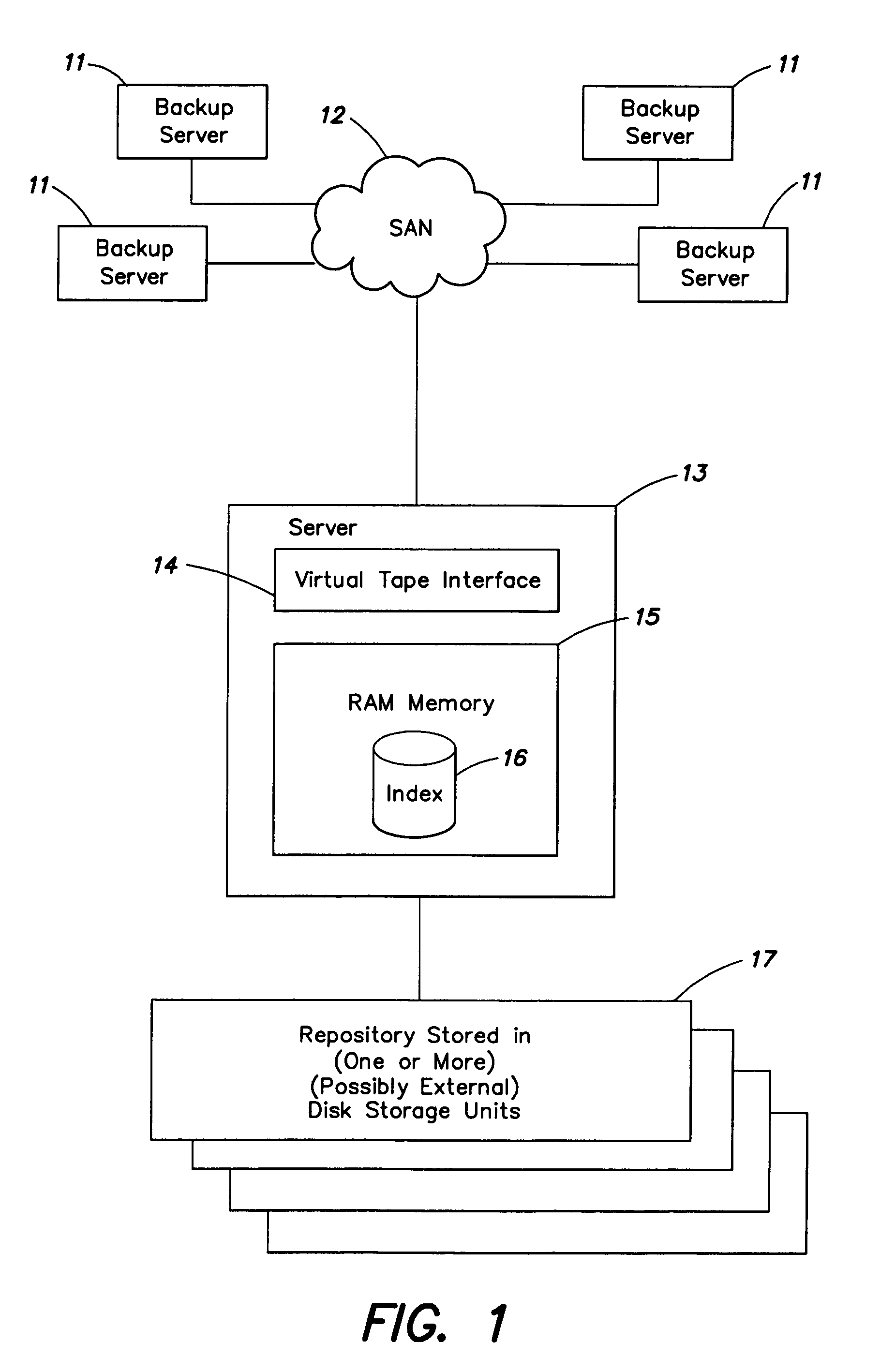

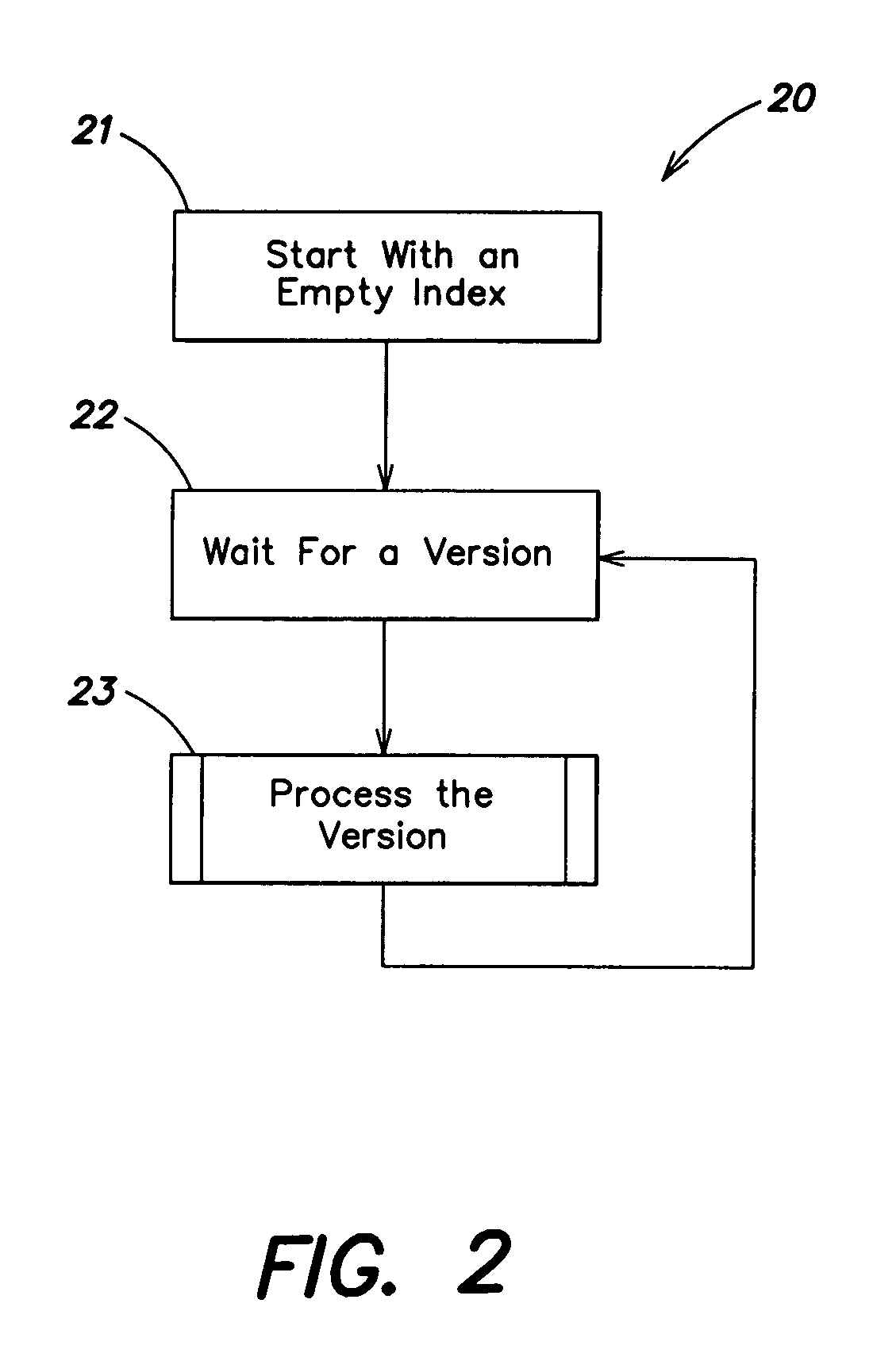

Systems and methods for efficient data searching, storage and reduction

InactiveUS20060059173A1Efficiently determinedReduce dataData processing applicationsDigital data information retrievalData segmentTheoretical computer science

Owner:IBM CORP

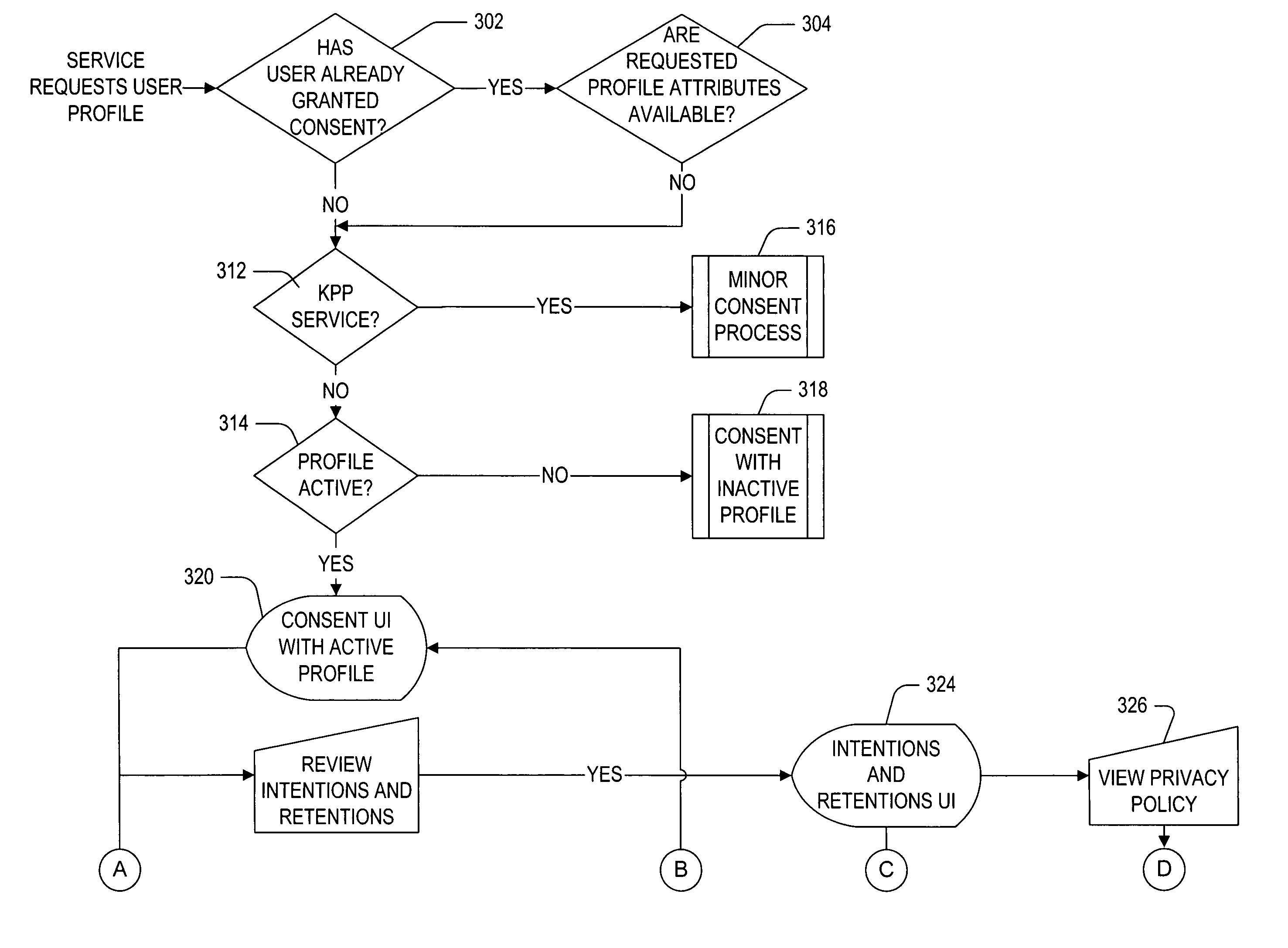

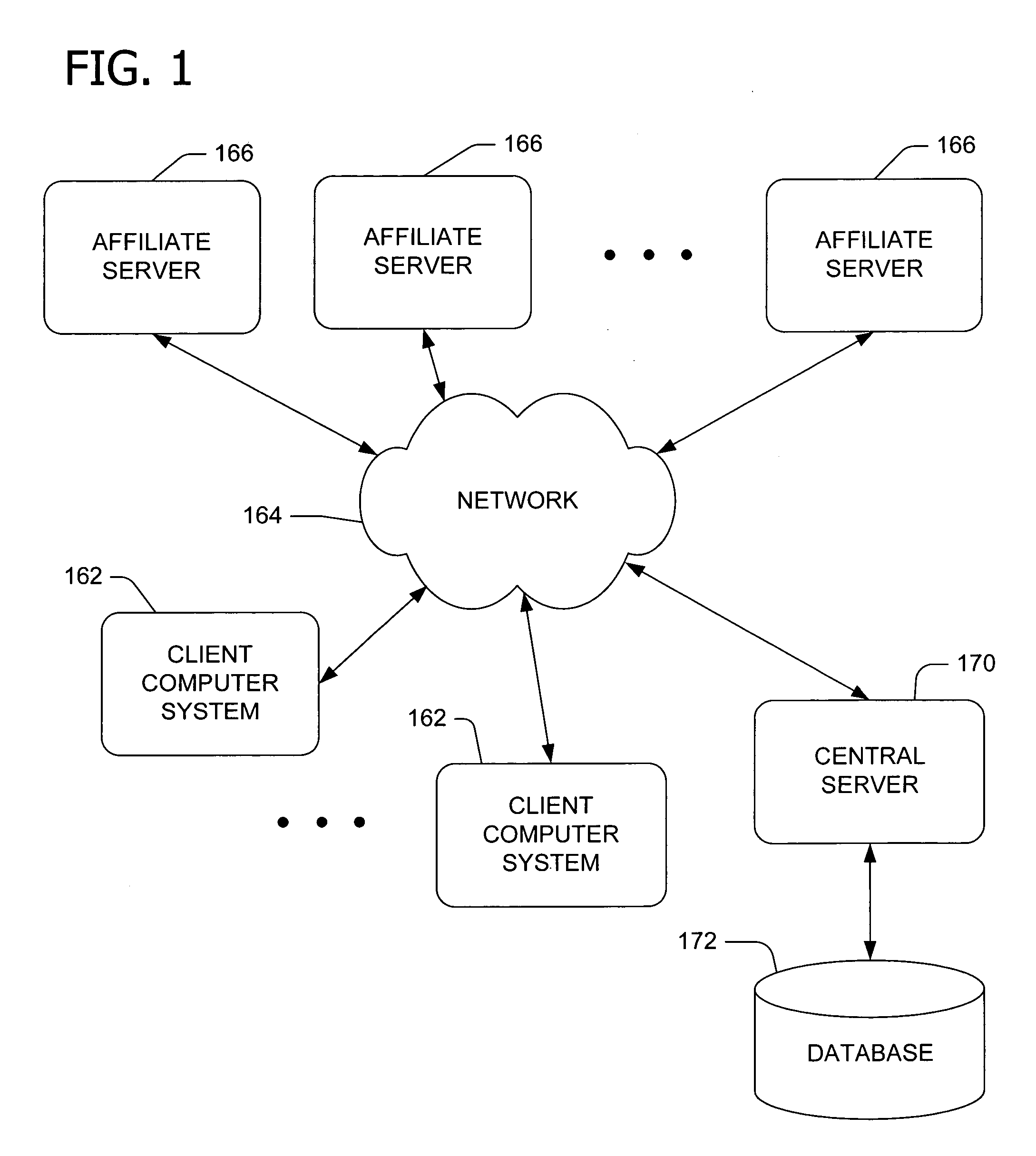

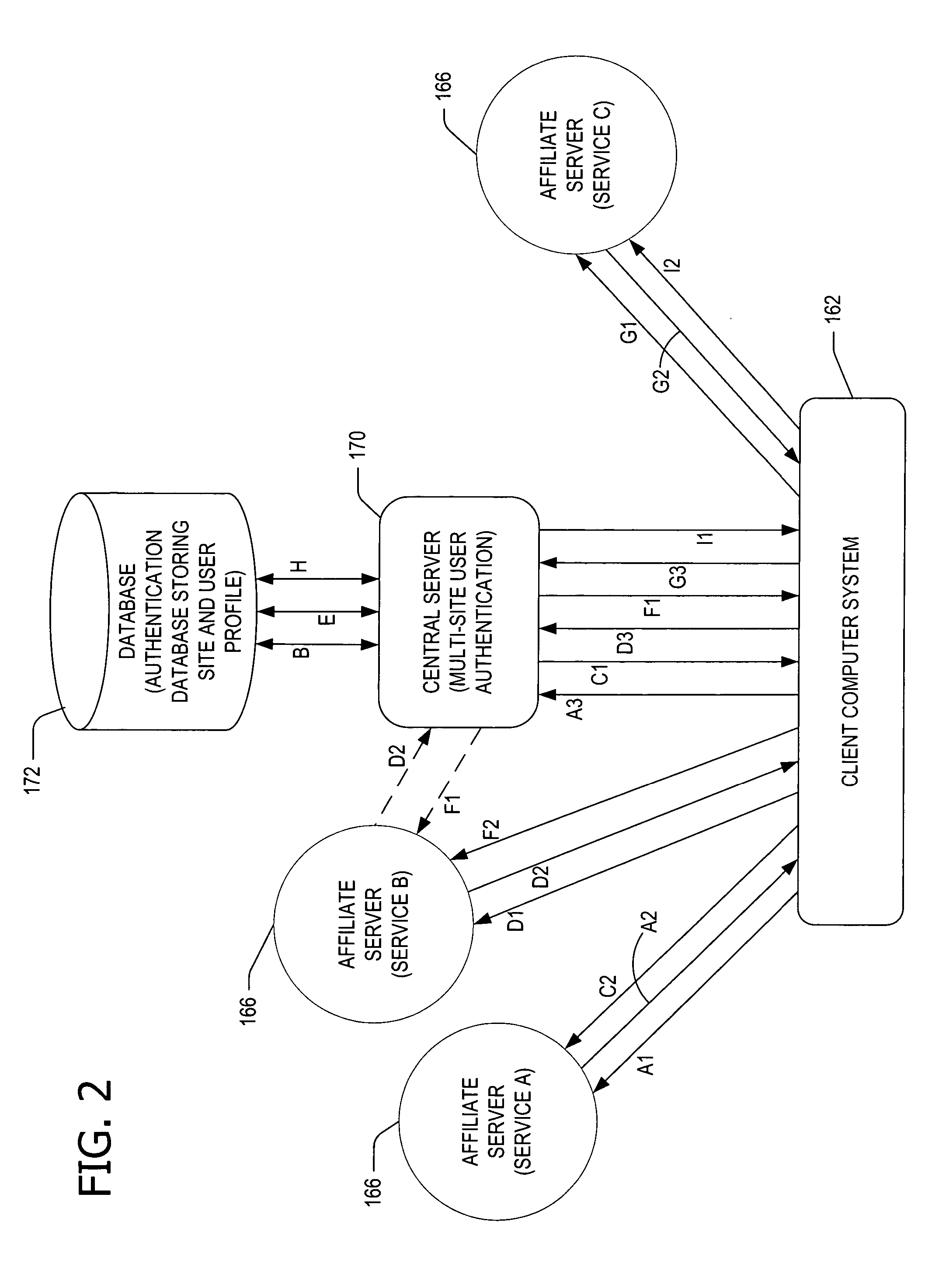

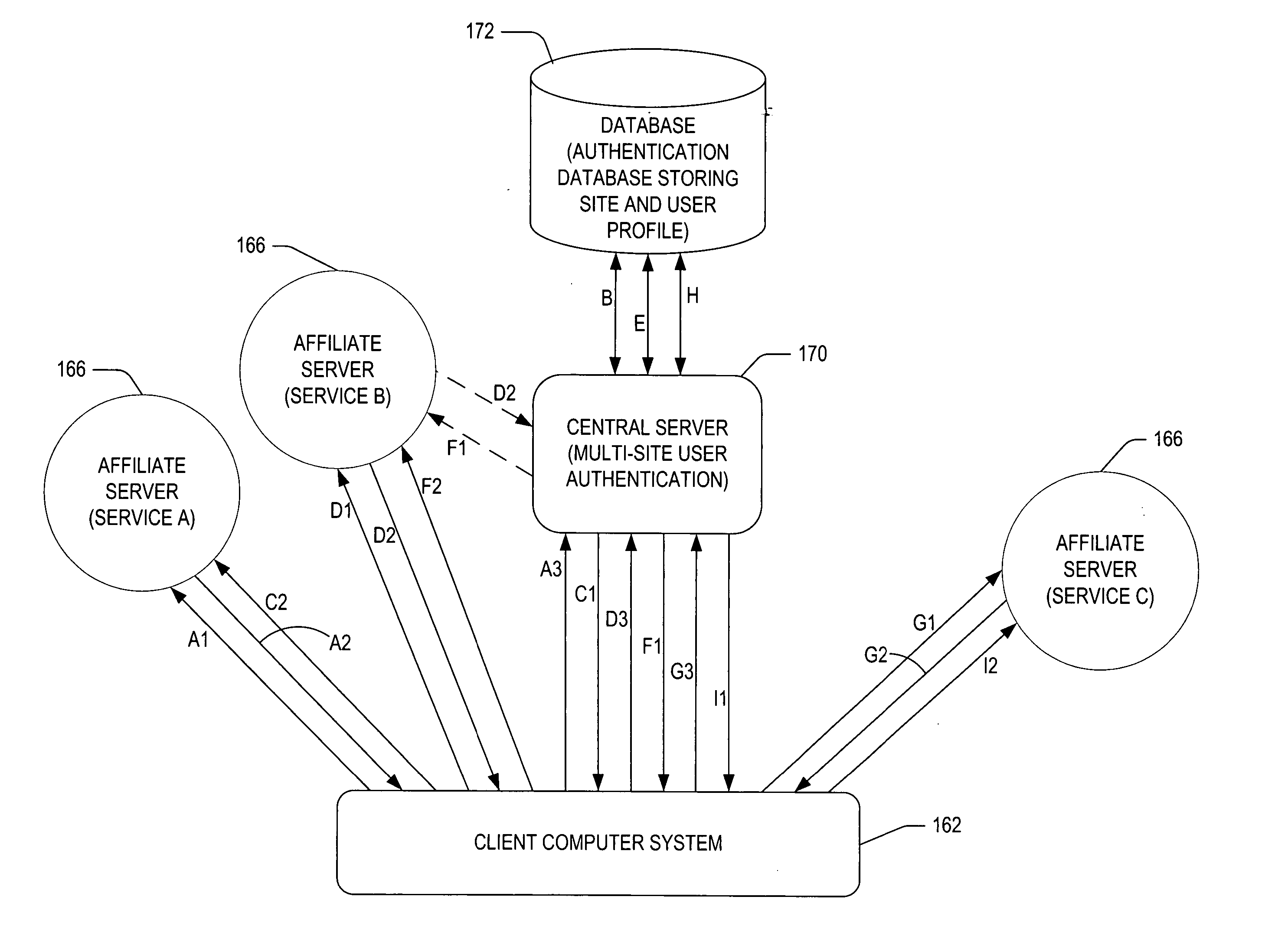

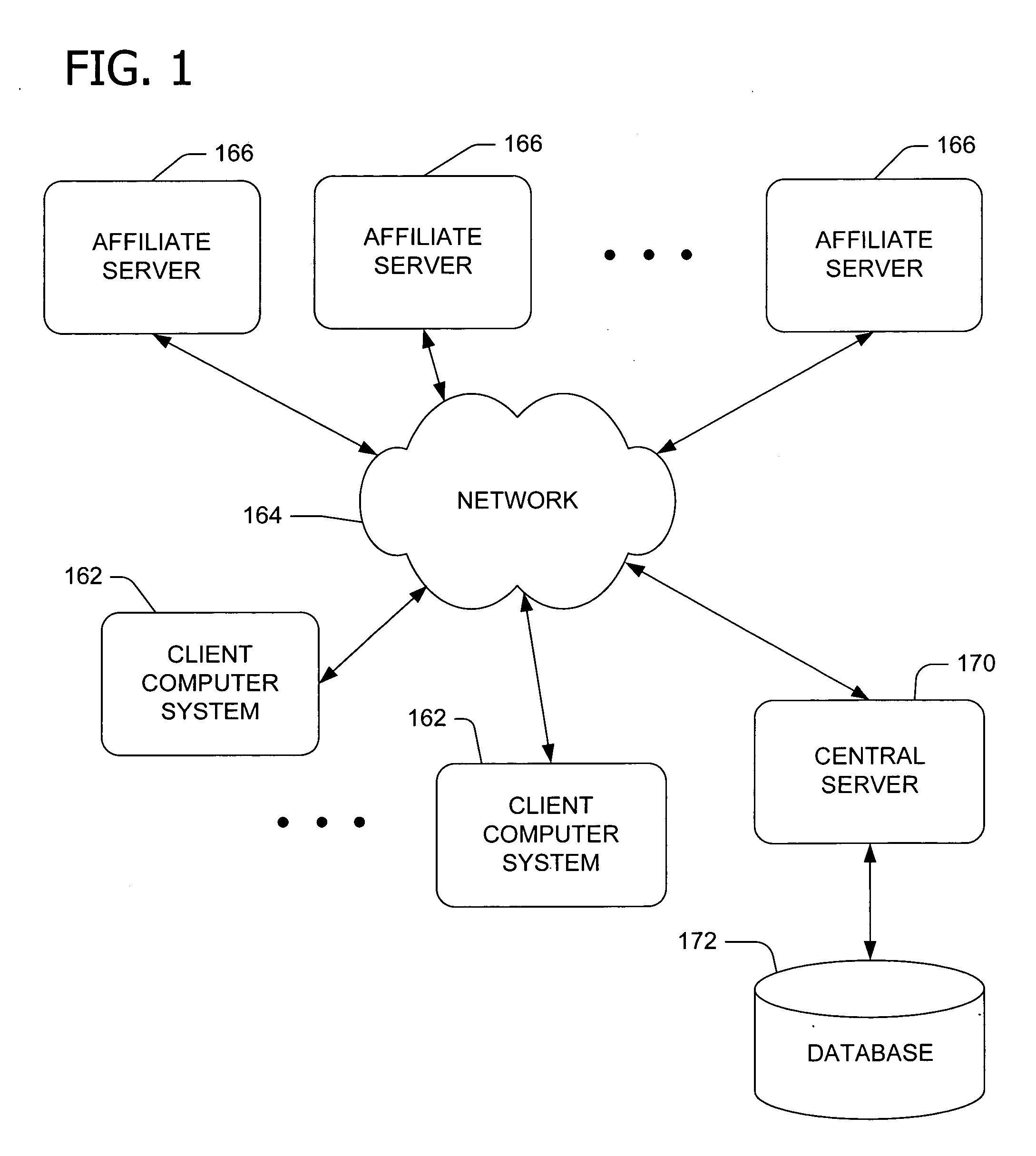

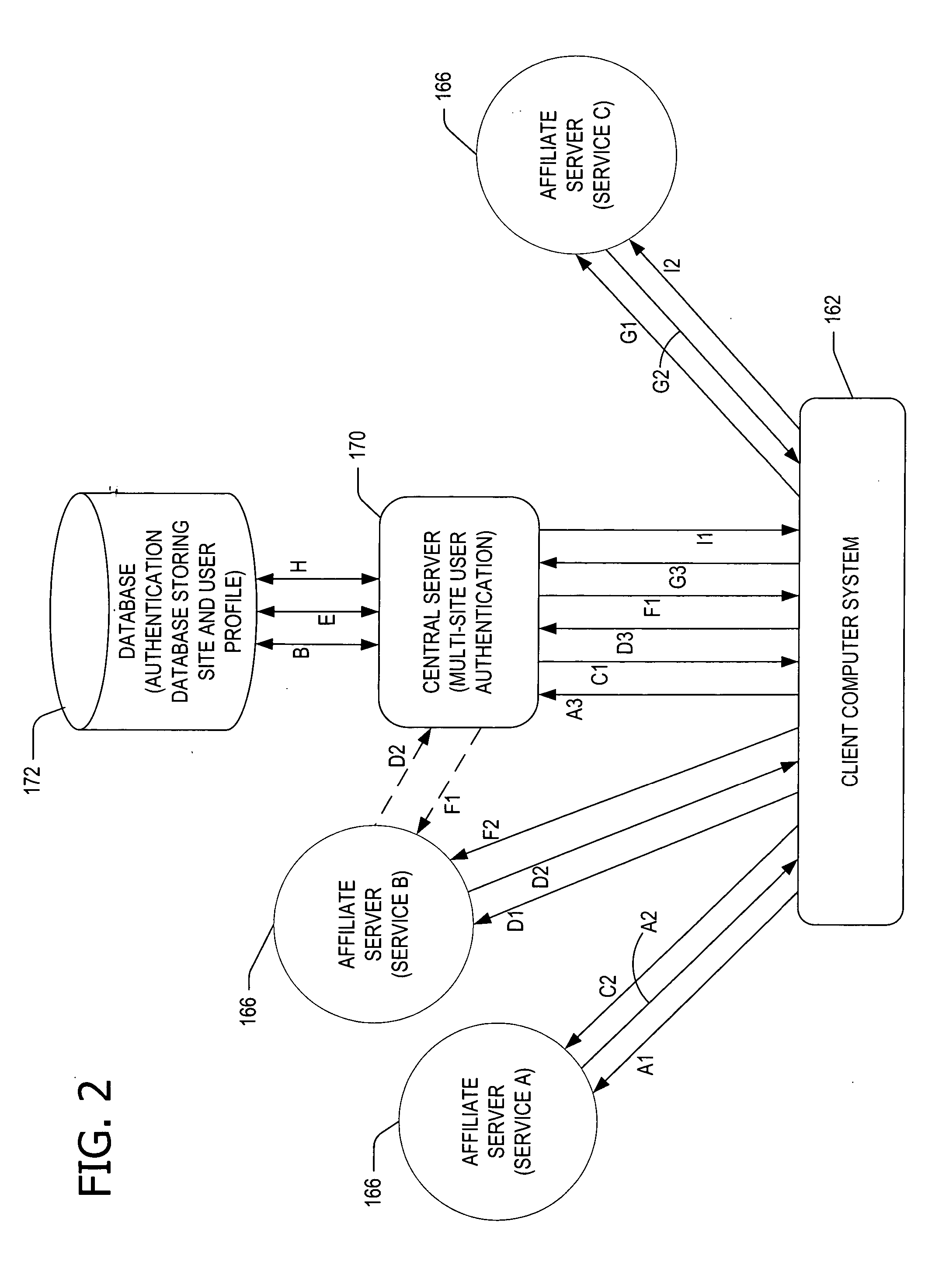

Profile and consent accrual

ActiveUS7590705B2Enhance information sharingLess laborDigital data processing detailsDigital data protectionPersonal detailsClient-side

Consent management between a client and a network server. In response to a request for consent, a central server determines if requested user information is included in a user profile associated with a user and if the user has granted consent to share the requested user information. A user interface is provided to the user via a browser of the client to collect the requested user information that is not included in the user profile and the consent to share the requested user information from the user. After receiving the user information provided by the user via the user interface, the service provided by the network server is allowed access to the received user information, and the central server updates the user profile. Other aspects of the invention are directed to computer-readable media for use with profile and consent accrual.

Owner:MICROSOFT TECH LICENSING LLC

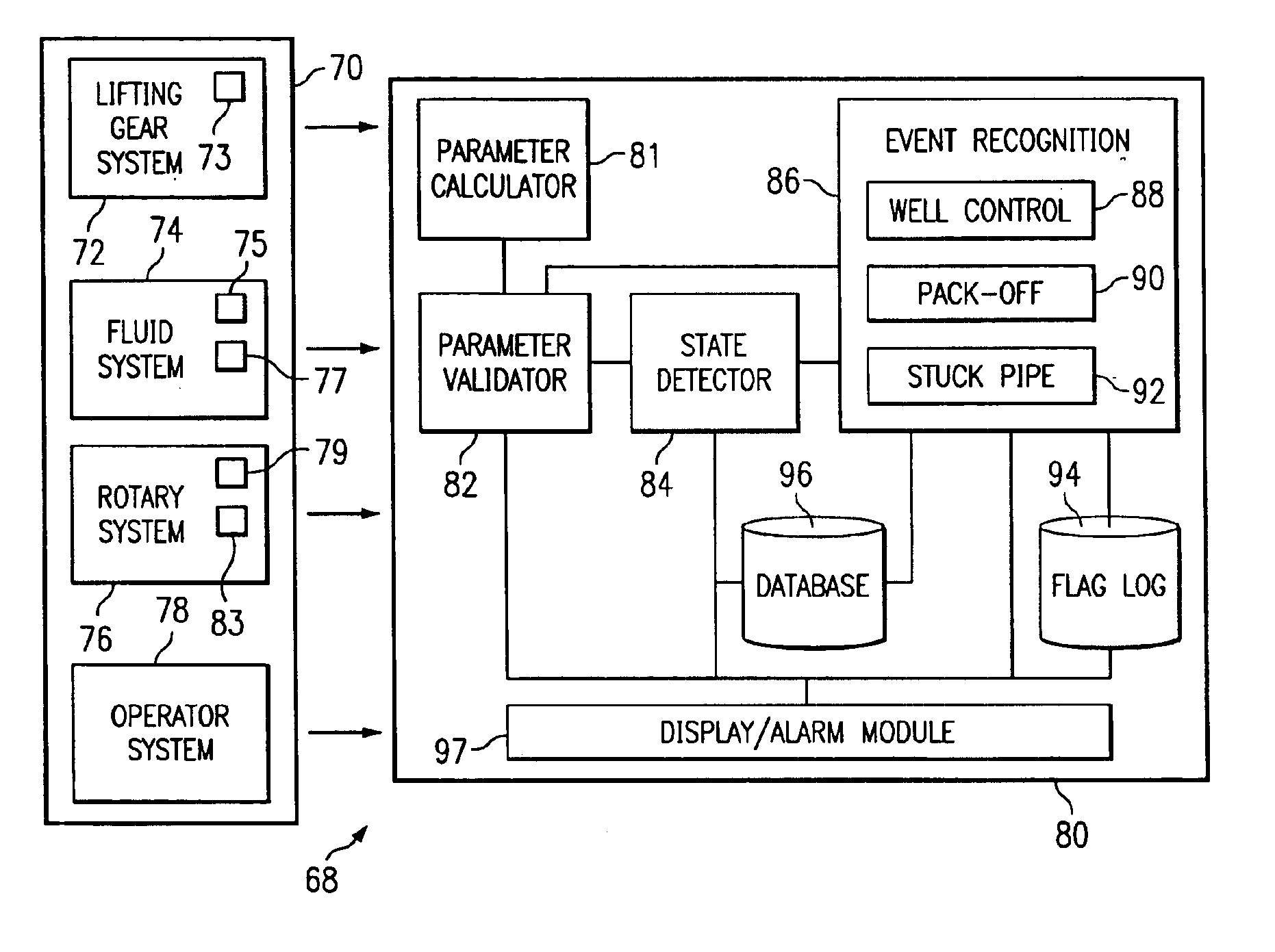

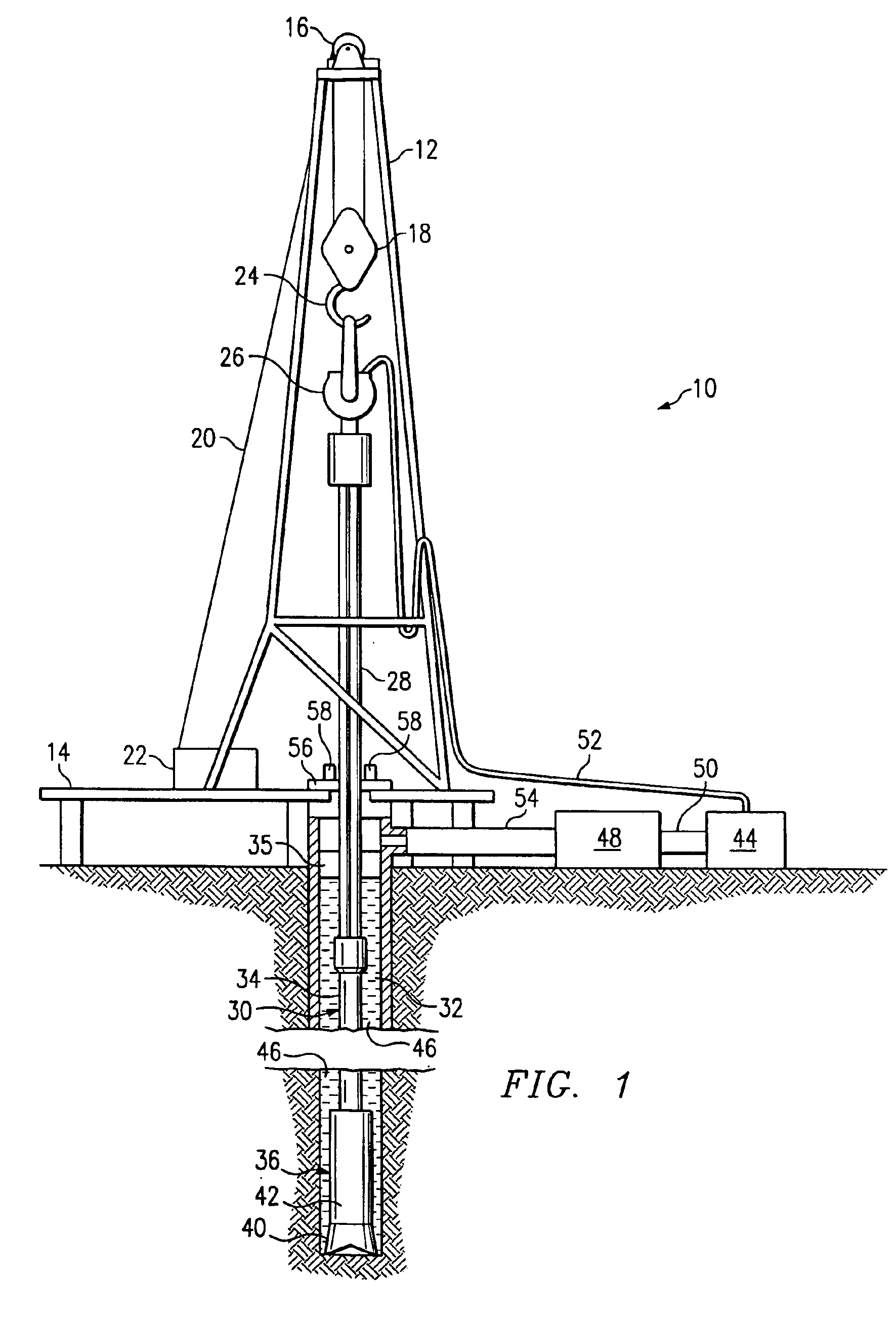

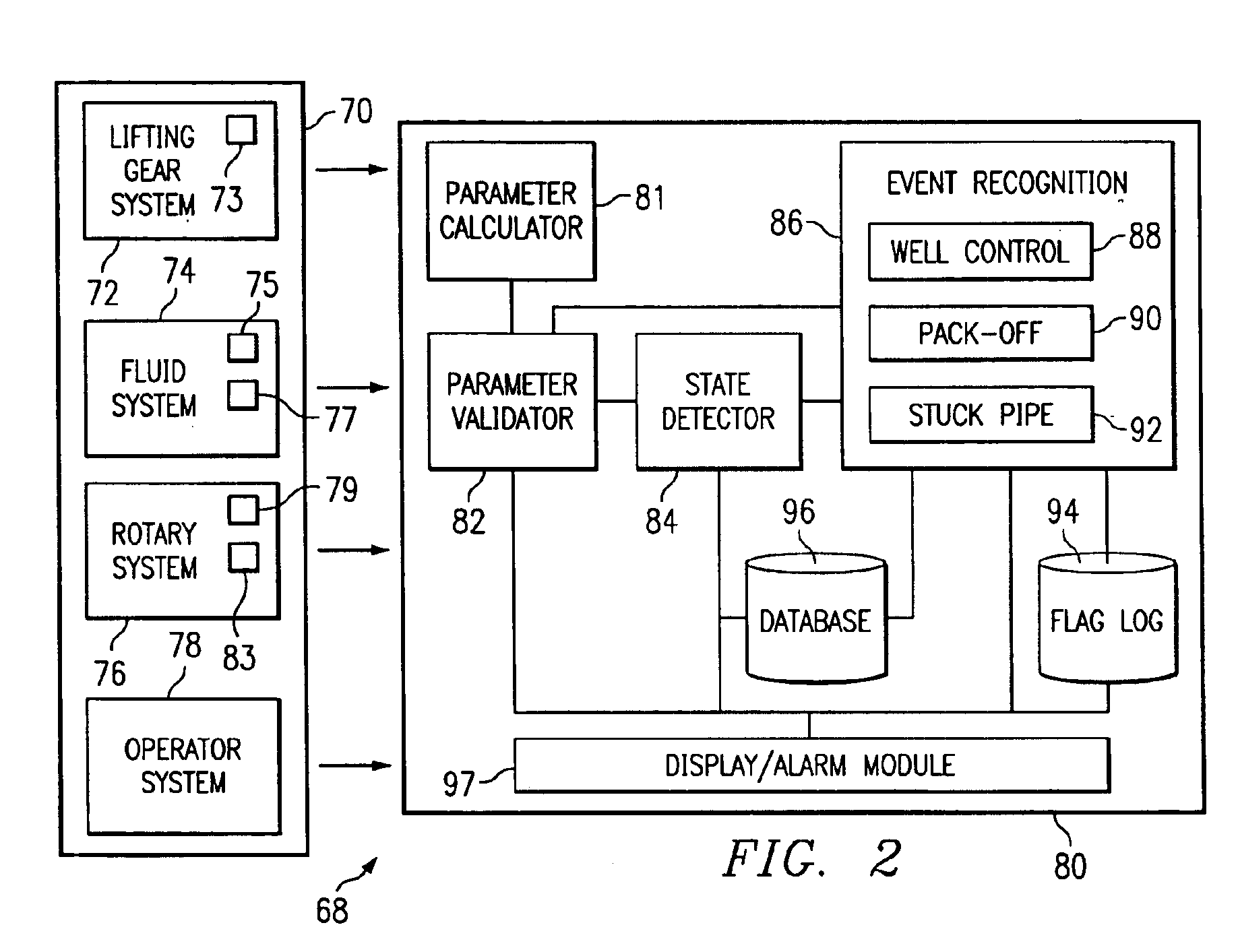

Automated method and system for determining the state of well operations and performing process evaluation

InactiveUS6892812B2Efficiently determinedImprove accuracyElectric/magnetic detection for well-loggingSurveyAutomated methodProcess assessment

An automated method and system for determining the state of a drilling or other suitable well operations includes storing a plurality of states for the well operation. Mechanical and hydraulic data is received for the well operation. Based on the mechanical and hydraulic data, one of the states is automatically selected as the state of the well operation. Process evaluation may be performed based on the state of the well operation.

Owner:TDE PETROLEUM DATA SOLUTIONS

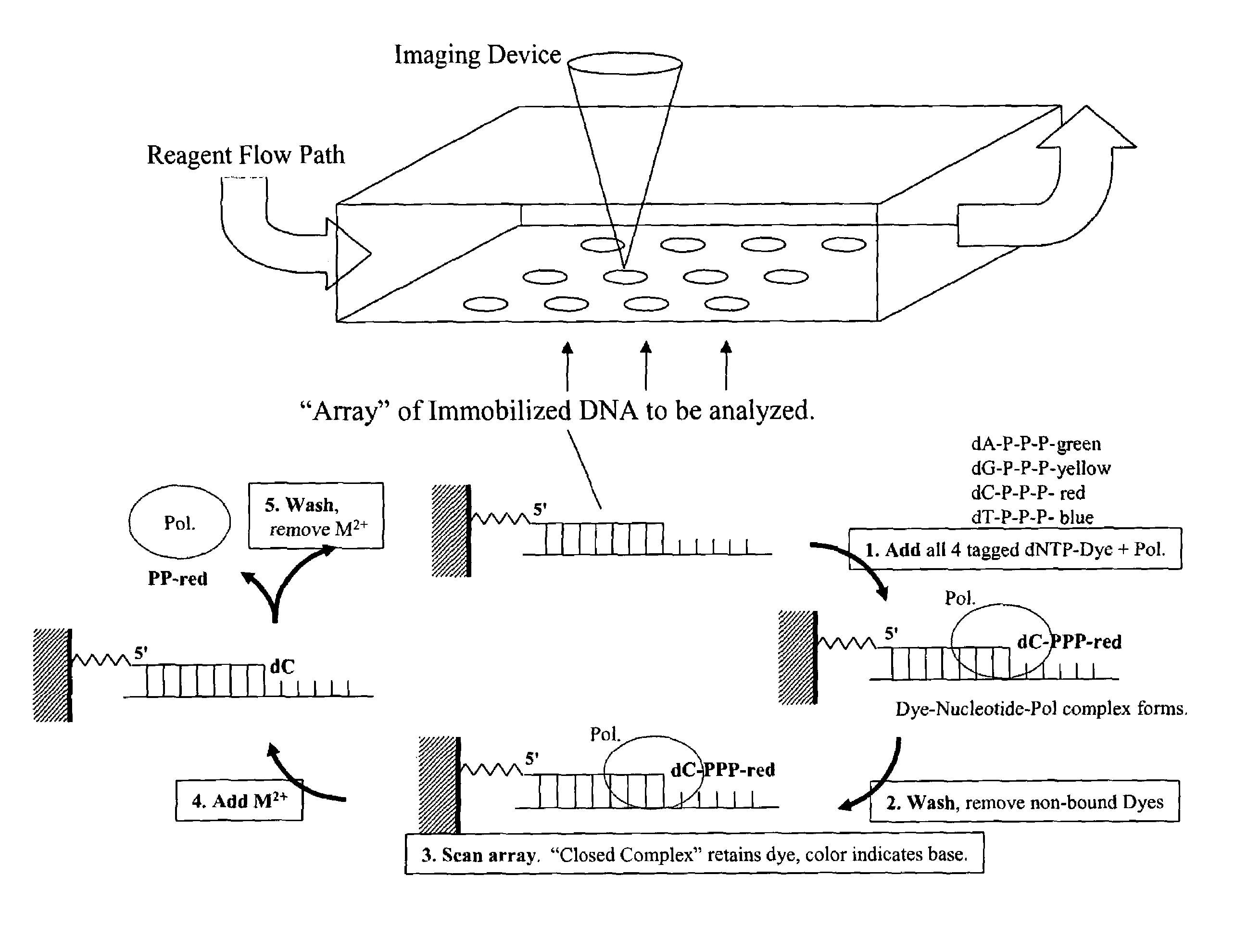

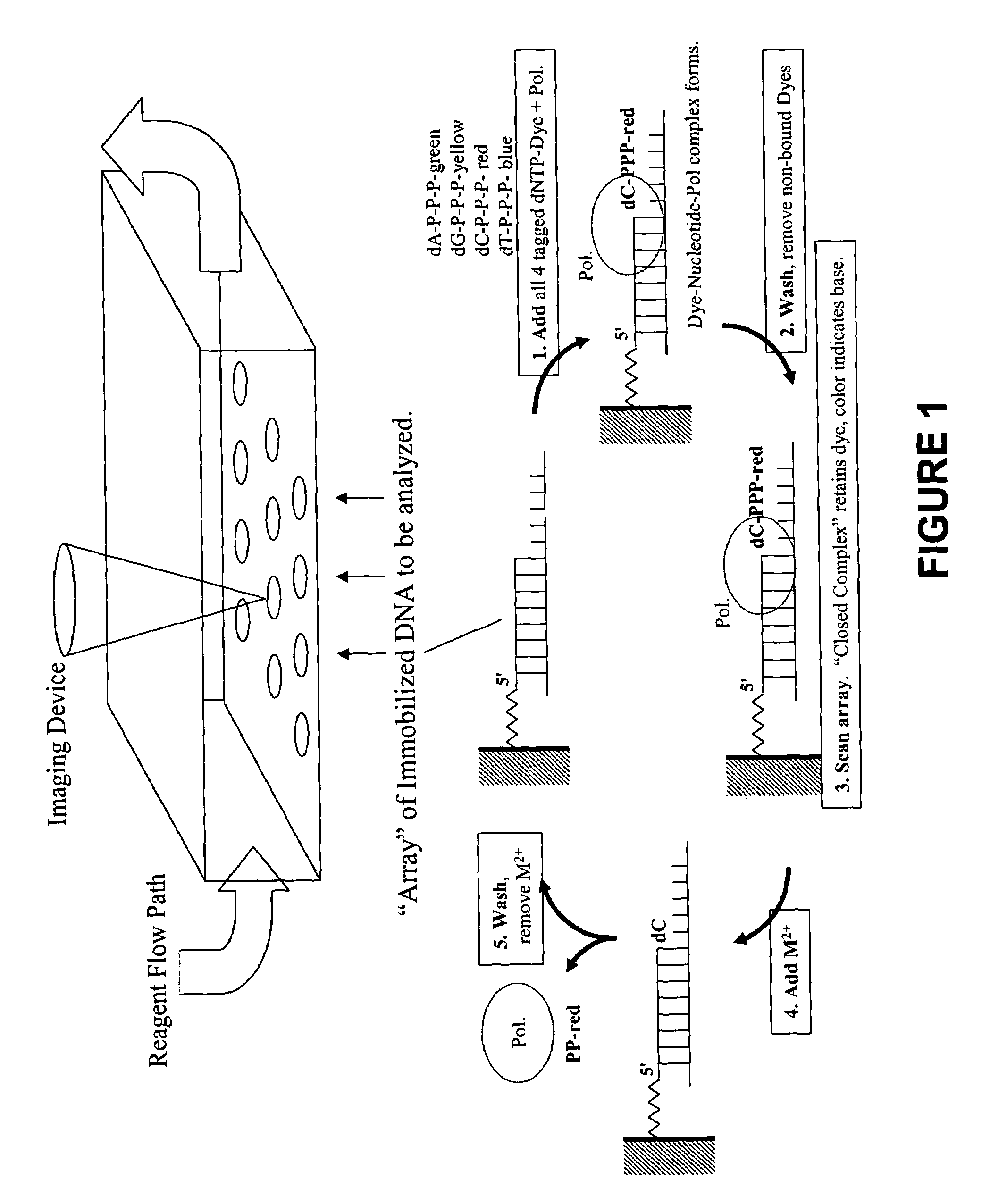

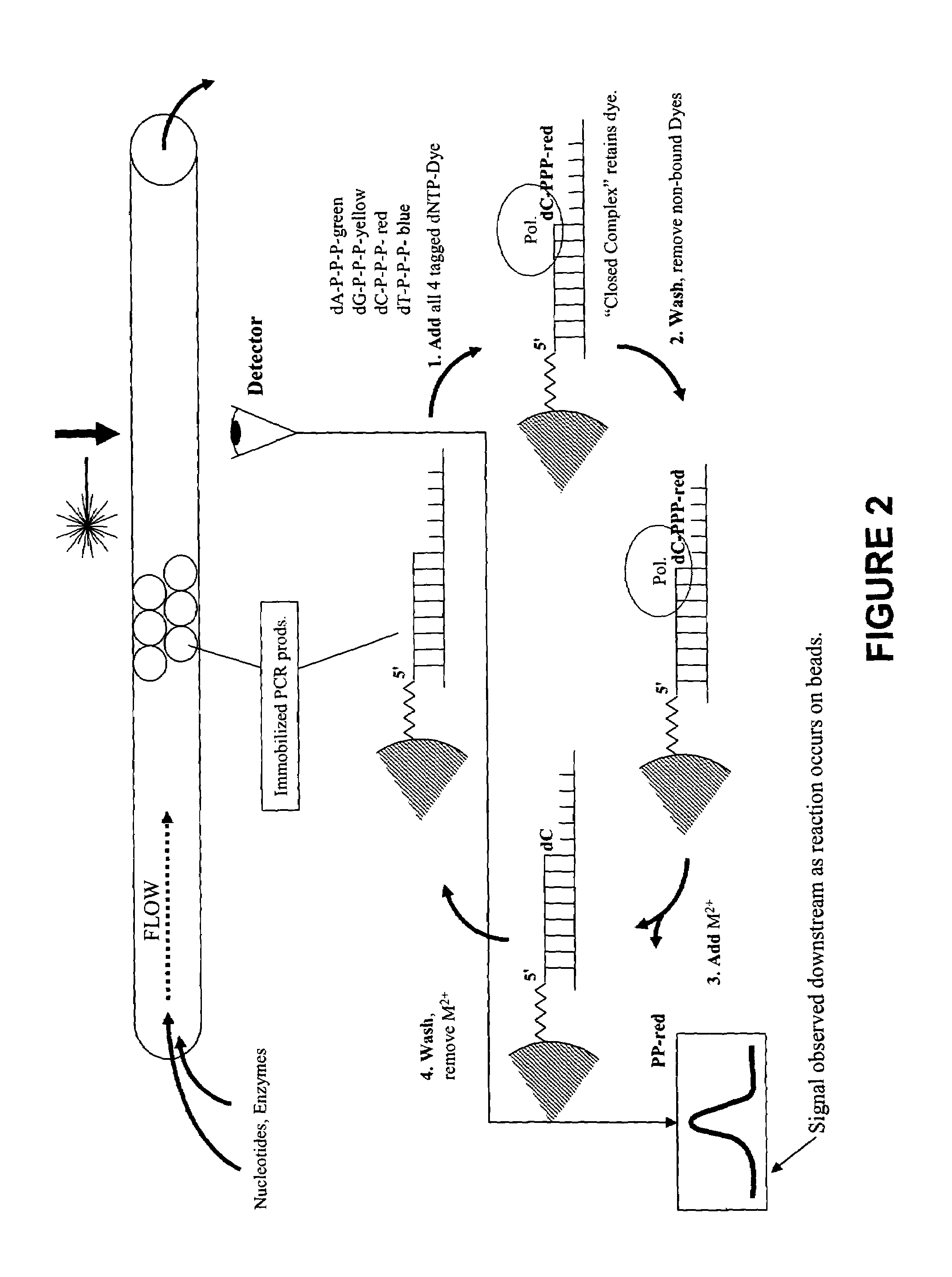

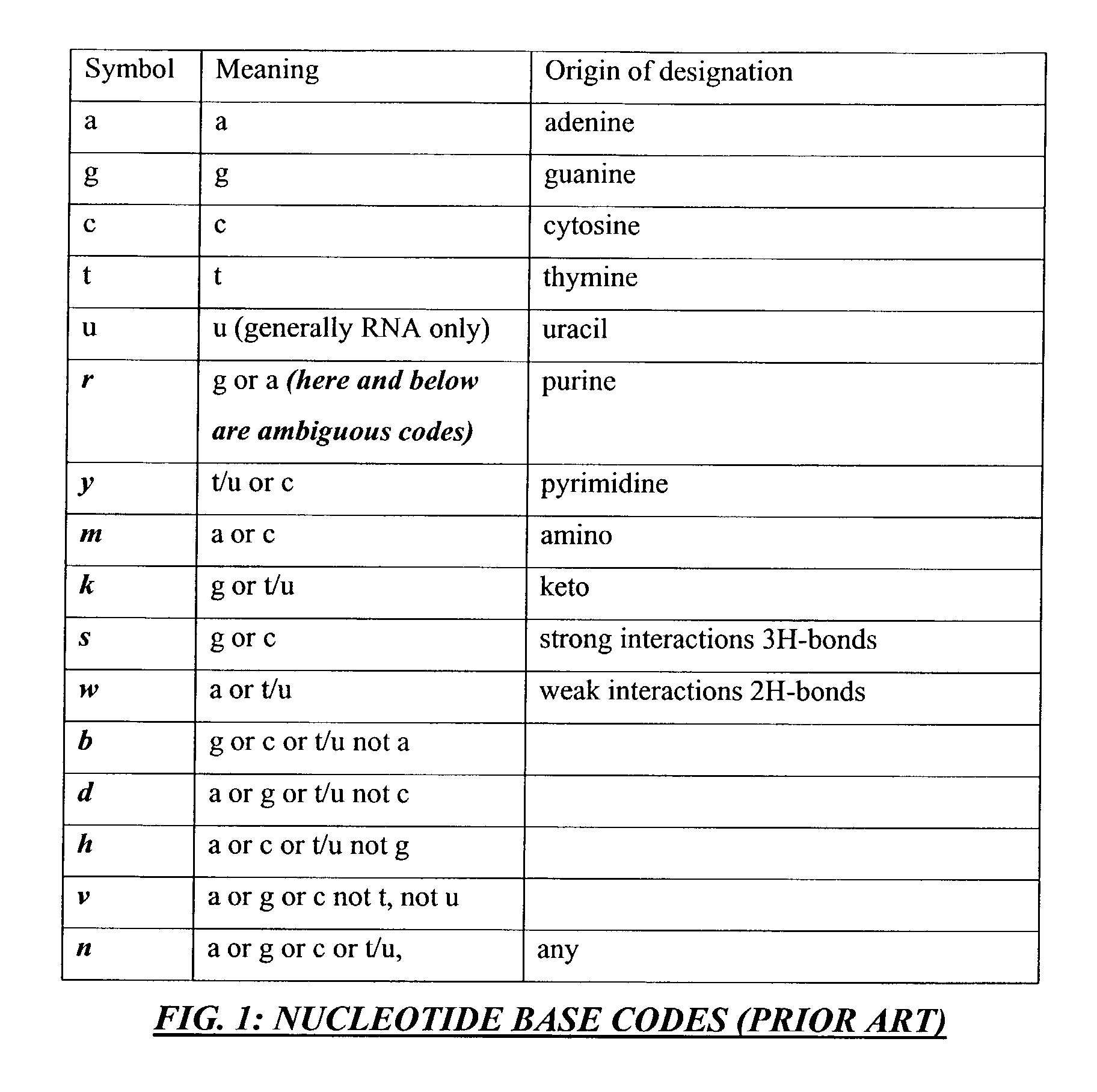

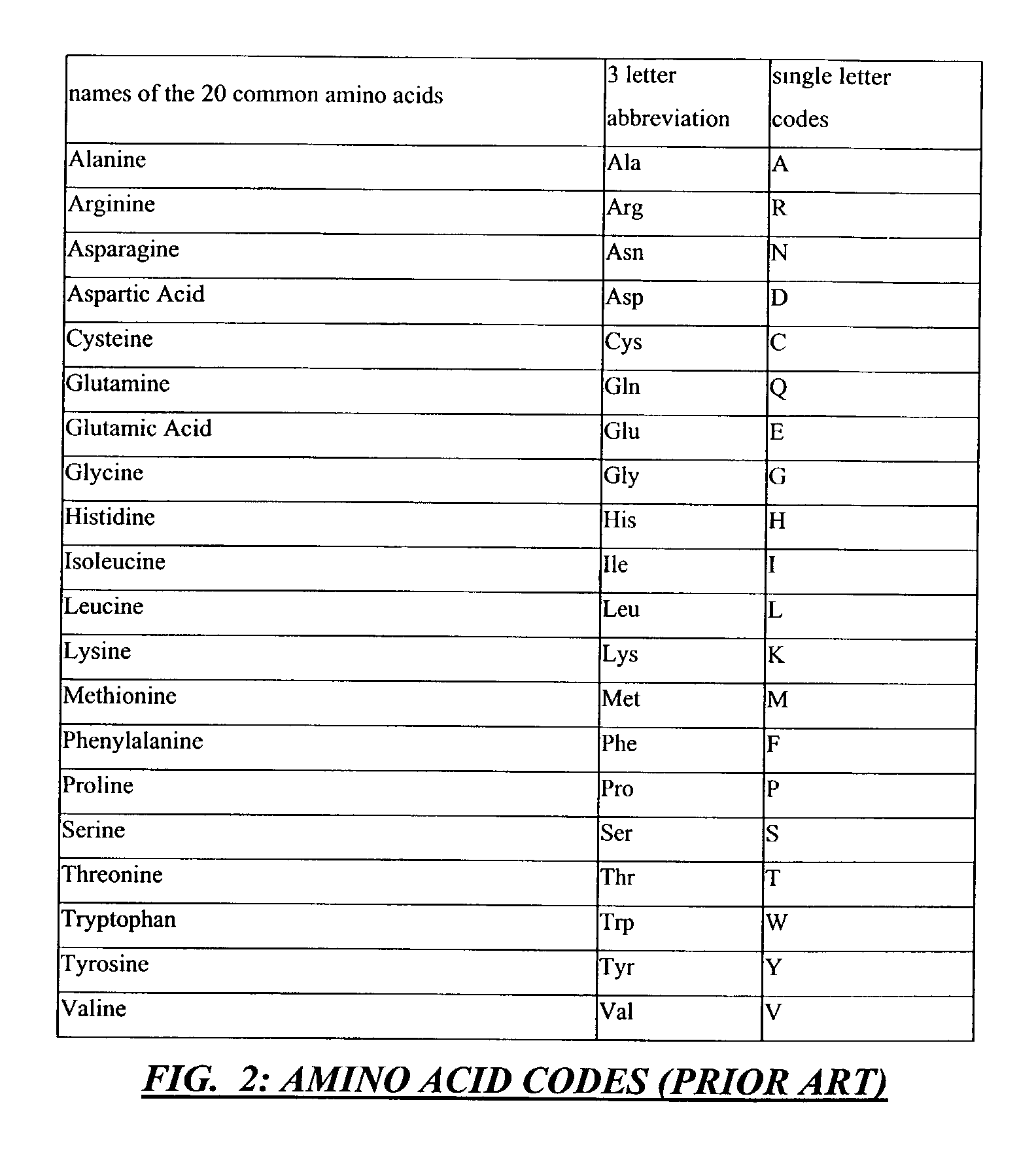

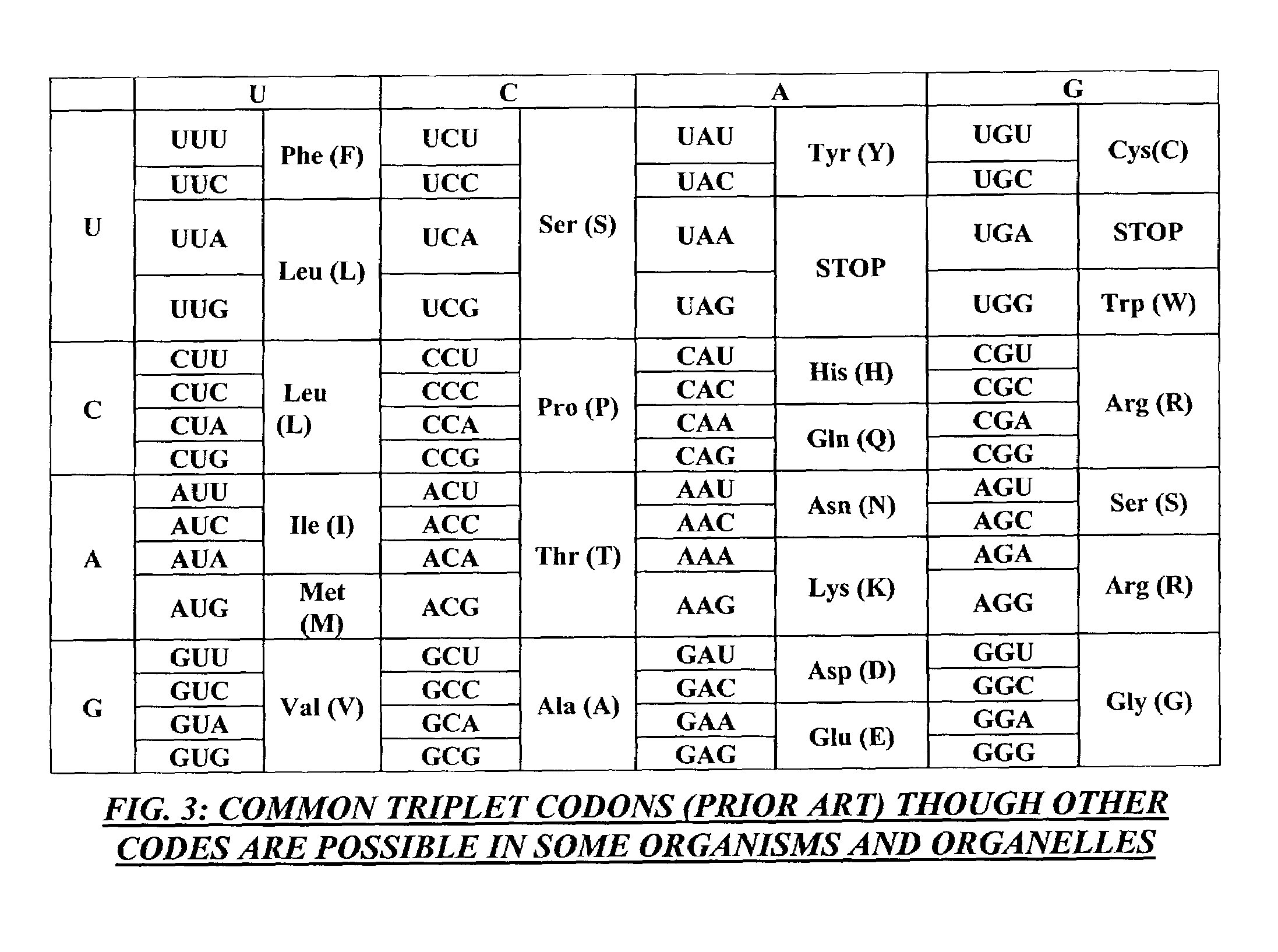

Rapid parallel nucleic acid analysis

ActiveUS7264934B2Efficiently determinedEliminates non-specificitySugar derivativesMicrobiological testing/measurementNucleotidePolymerase L

This invention provides methods for massive parallel nucleic acid analysis. A closed complex of nucleic acid template, nucleotide and polymerase can be formed during polymerase reaction, absent divalent metal ion. This is used to trap the nucleotide complementary to the next template nucleotide in the closed complex. Detection of the trapped nucleotide allows determination of the sequence of this next correct nucleotide. In this way, sequential nucleotides of a nucleic acid template can be identified, effectively determining the sequence. This method is applied to sequence multiple templates in parallel, particularly if they are immobilized on a solid support.

Owner:GLOBAL LIFE SCI SOLUTIONS USA LLC

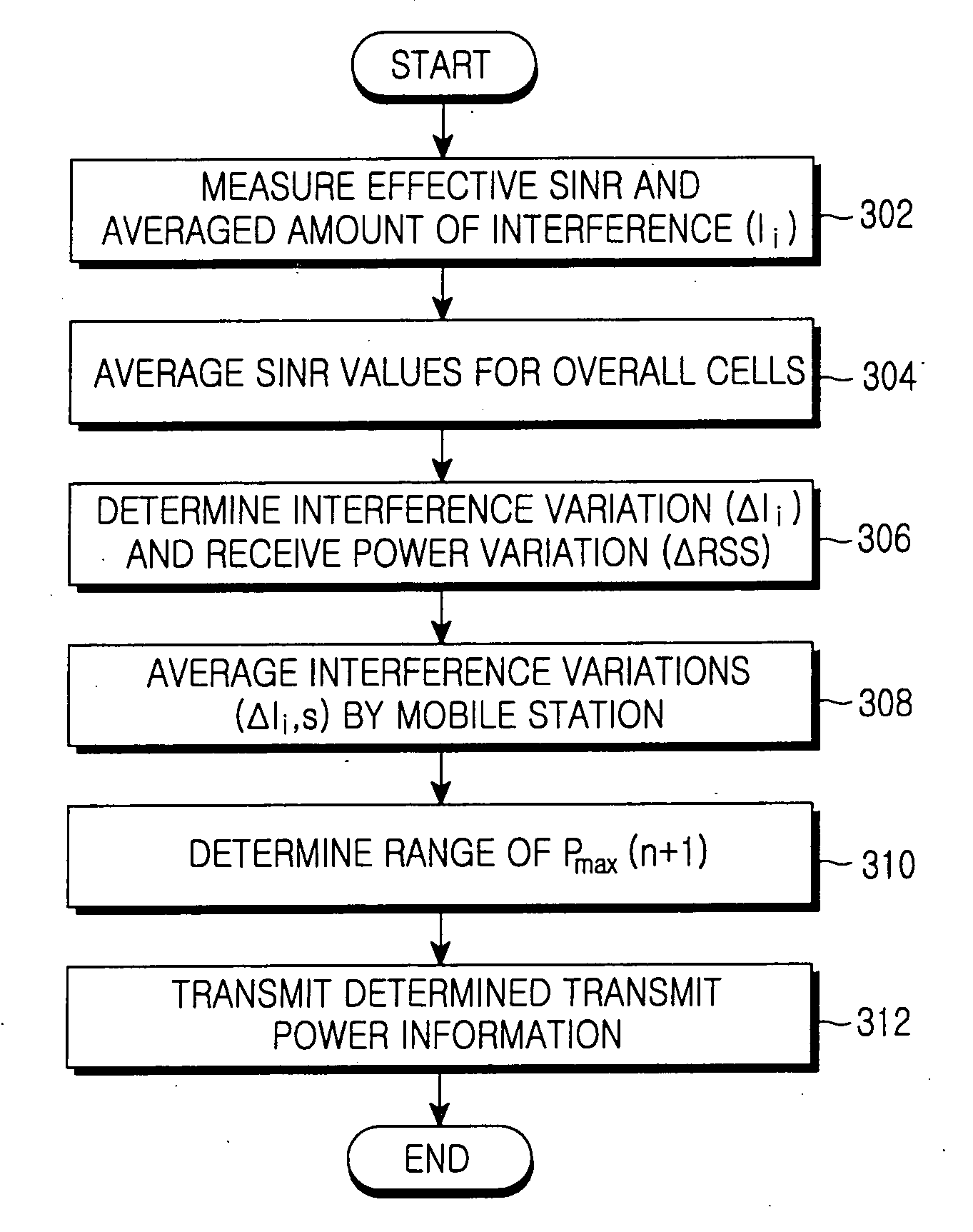

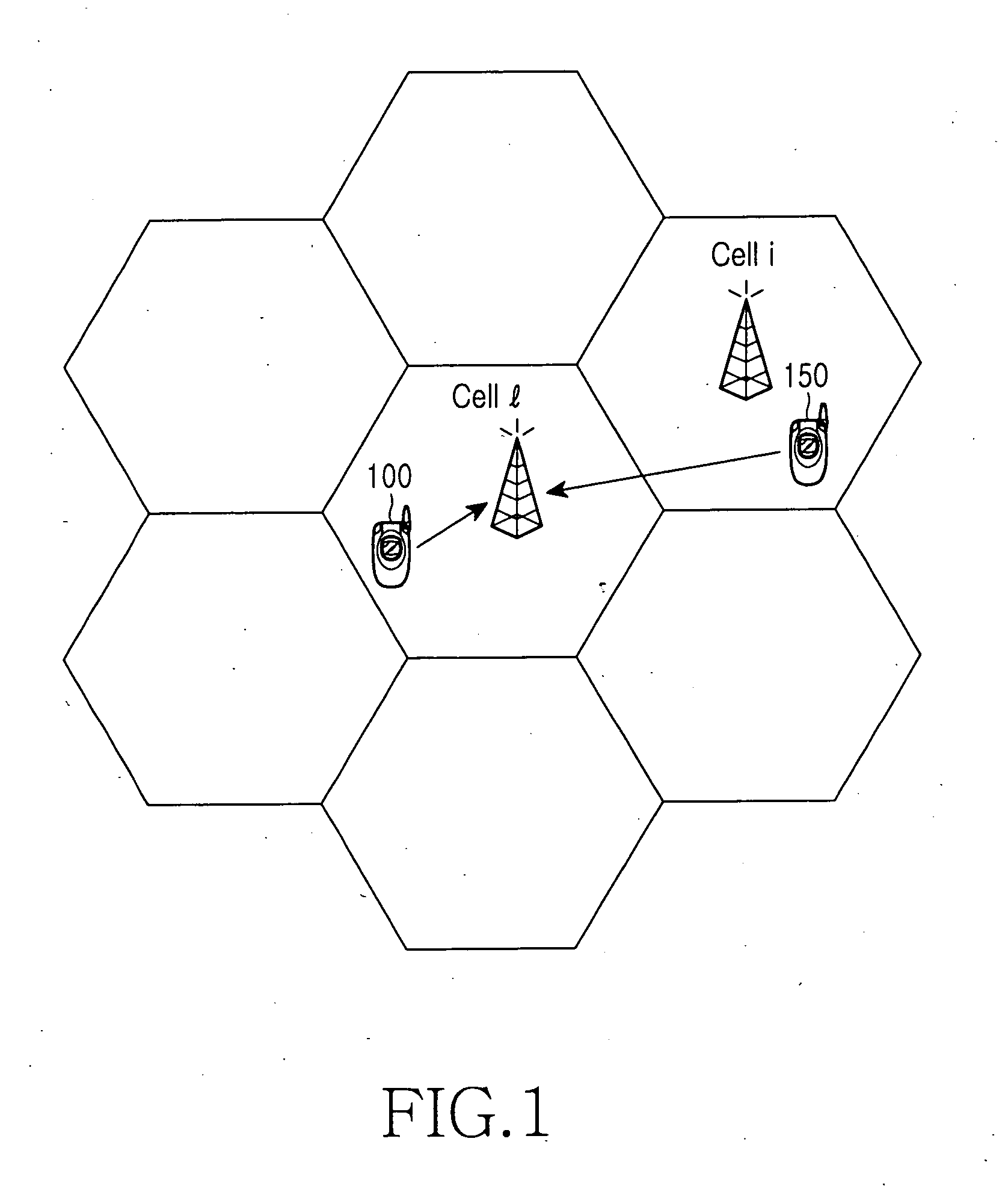

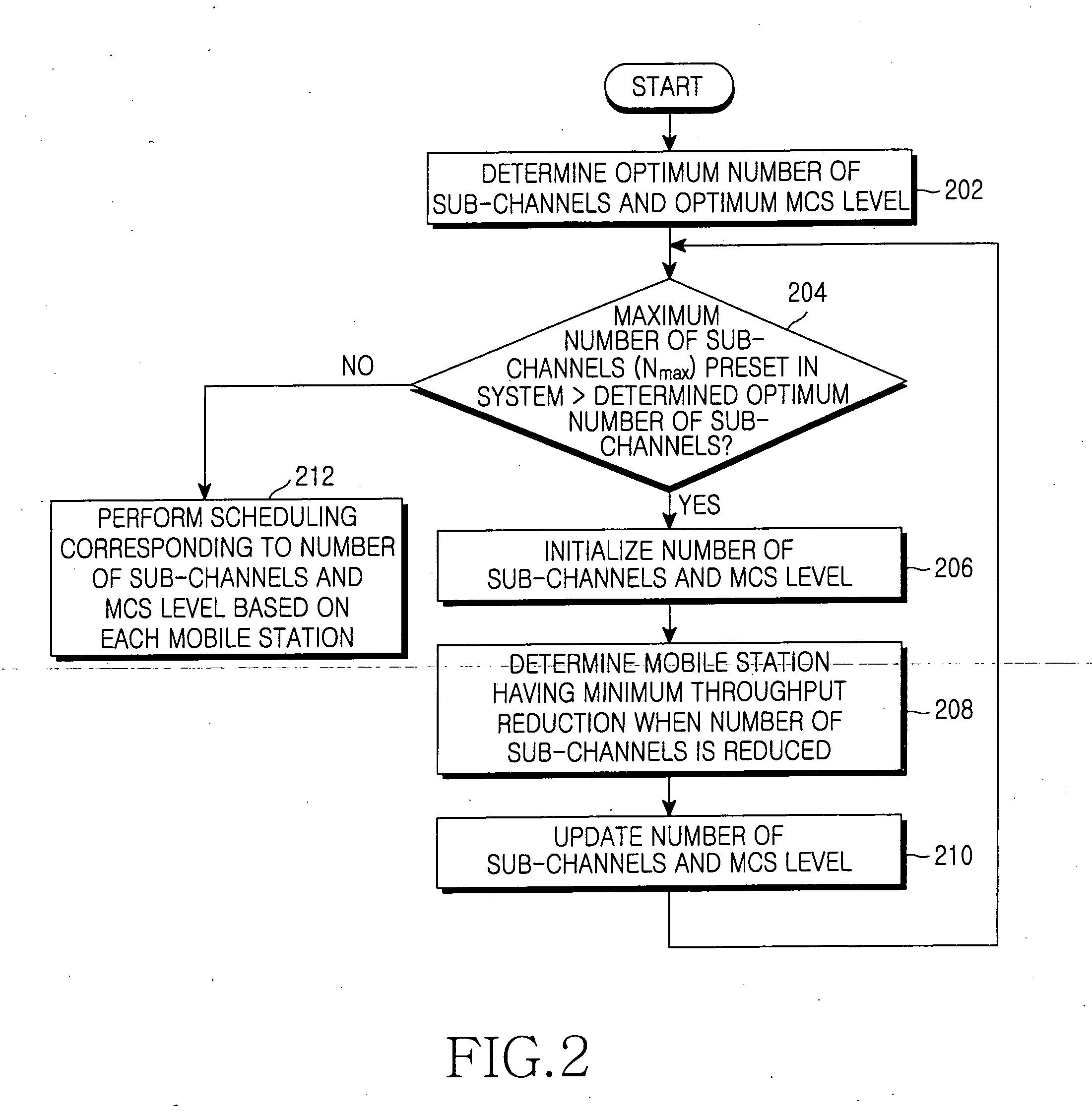

Method for uplink scheduling in communication system using frequency hopping-orthogonal frequency division multiple access scheme

InactiveUS20060094372A1Efficiently determinedEfficient powerModulated-carrier systemsCriteria allocationCarrier signalFrequency band

Disclosed is a method for uplink scheduling in a communication system. The method for uplink scheduling in a communication system having a cellular structure hopping between sub-channels according to a predetermined rule whenever a signal is transmitted The communication system dividing a whole frequency band into a plurality of sub-carrier bands and including the sub-channels which are sets of the sub-carrier bands. The method includes determining a number of sub-channels to be allocated to a mobile station such that throughput of the mobile station is maximized based on a first predetermined condition in which a mobile station having a superior channel state is allocated with a greater number of sub-channels than a mobile station having an inferior channel state, and determining a modulation and coding scheme level according to a signal-to-interference and noise ratio (SINR) of a downlink channel reported by the mobile station based on a second predetermined condition capable of improving a channel state of the mobile station having an inferior channel state.

Owner:SAMSUNG ELECTRONICS CO LTD +1

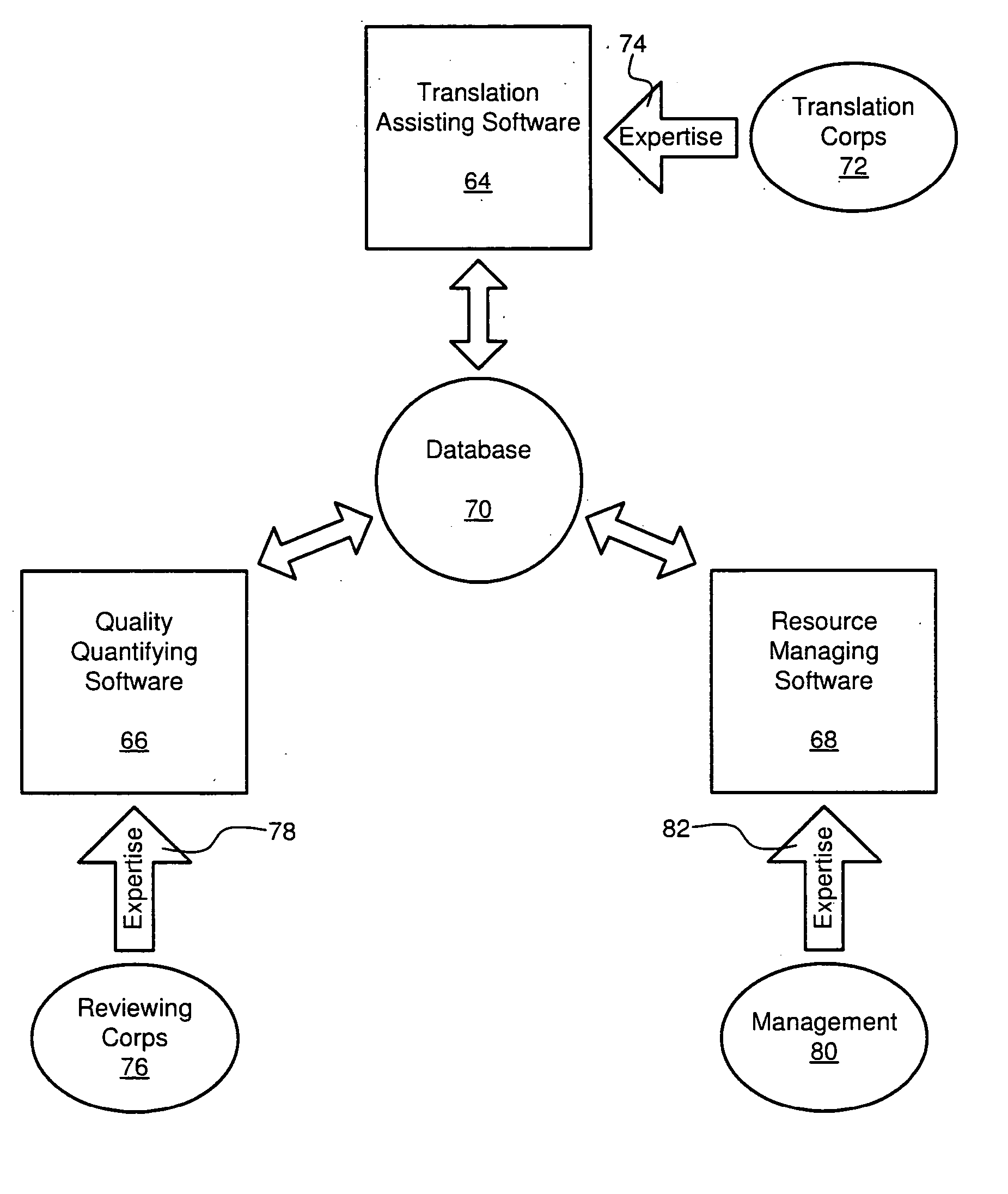

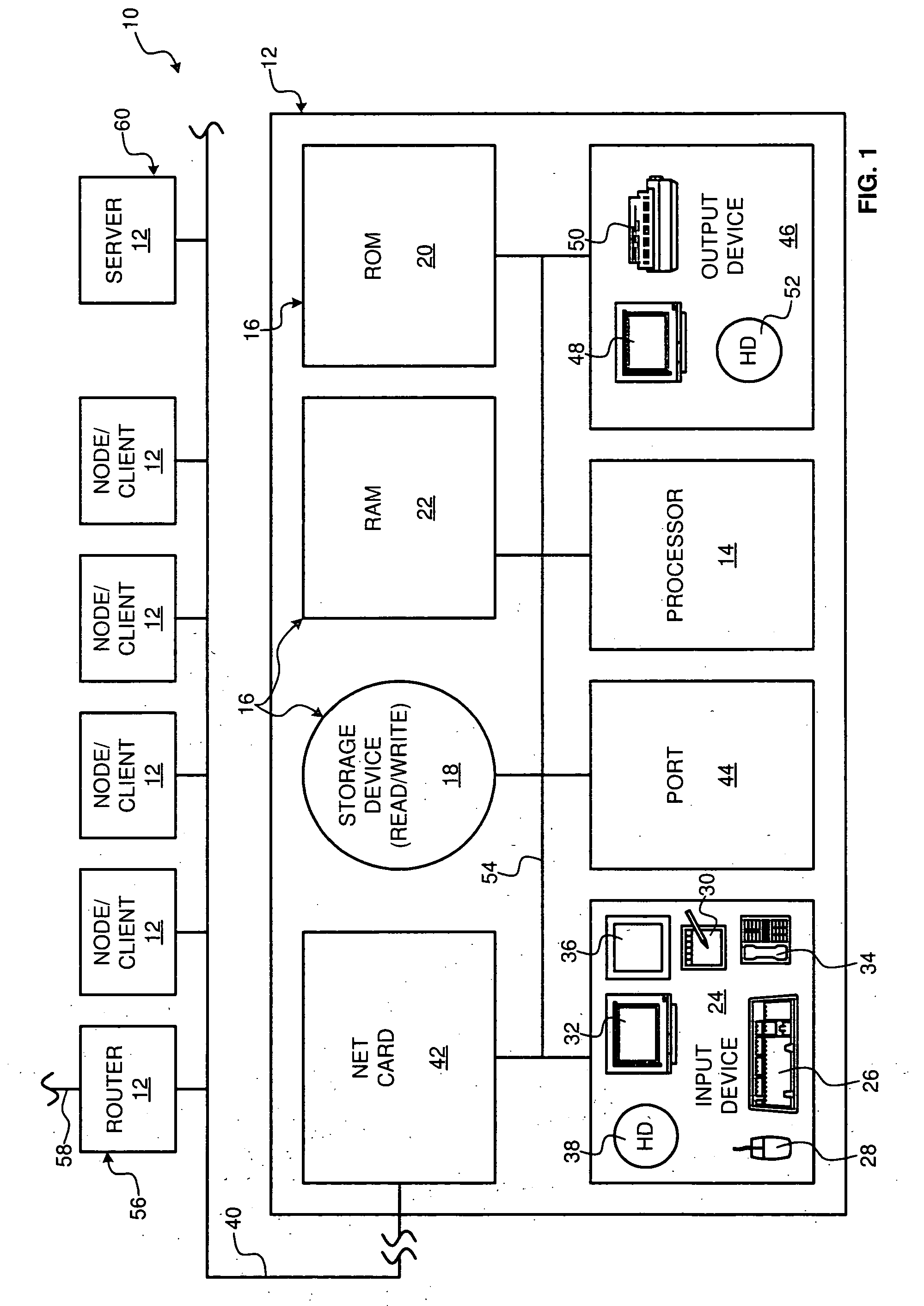

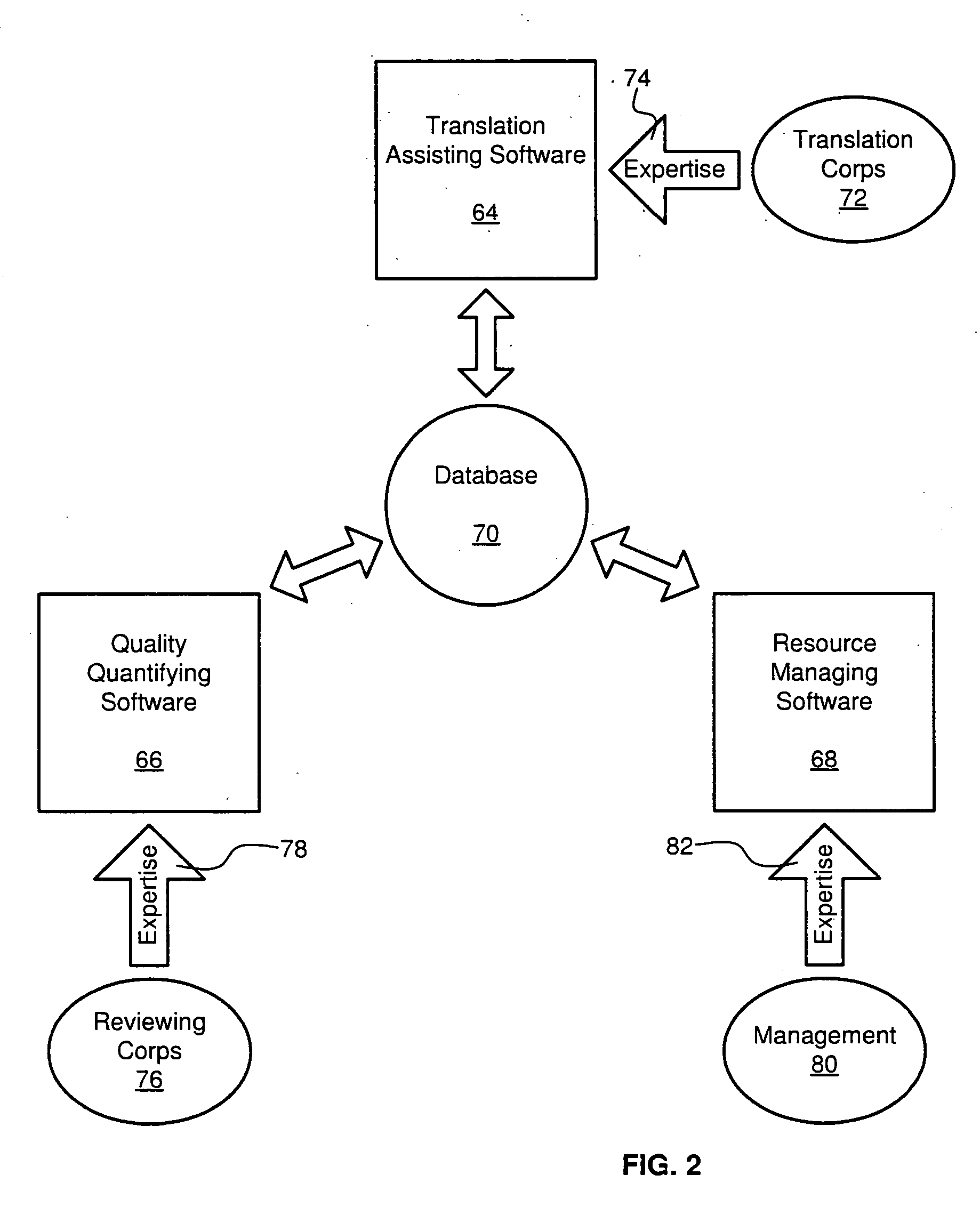

Translation quality quantifying apparatus and method

ActiveUS20070050182A1Effectively and predictably translateEfficiently determinedNatural language translationSpeech analysisTest sampleQuality assessment

A system for automating the quality evaluation of a translation. The system may include a computer having a processor and memory device operably connected to one another. A source text in a first language may be stored within the memory device. A target text comprising a translation of the source text into a second language may also be stored within the memory device. Additionally, a plurality of executables may be stored on the memory device and be configured to, when executed by the processor, independently identify a test sample comprising one or more blocks, each comprising a matched set having a source portion selected from the source text and a corresponding target portion selected from the target text.

Owner:MULTILING CORP

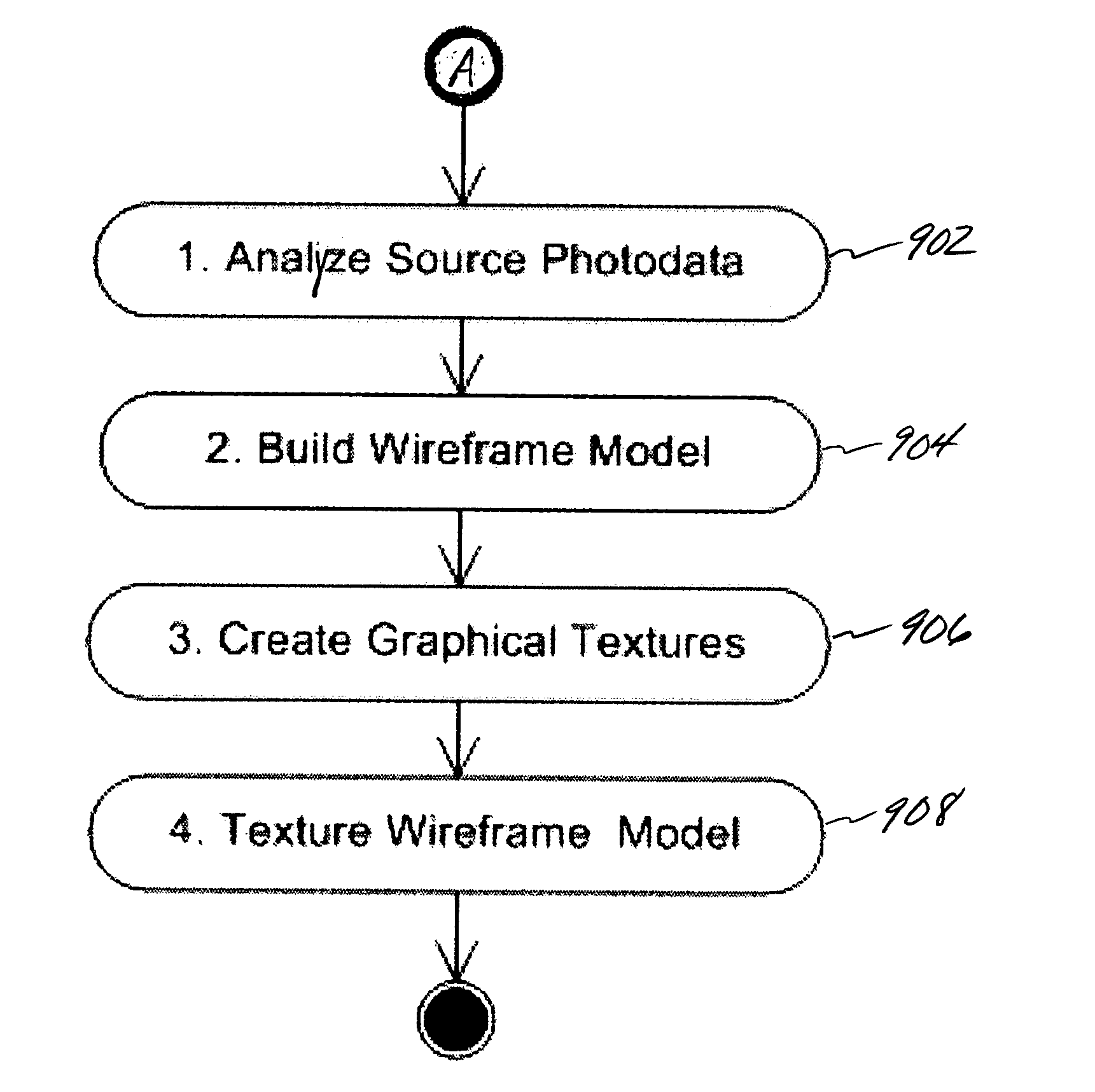

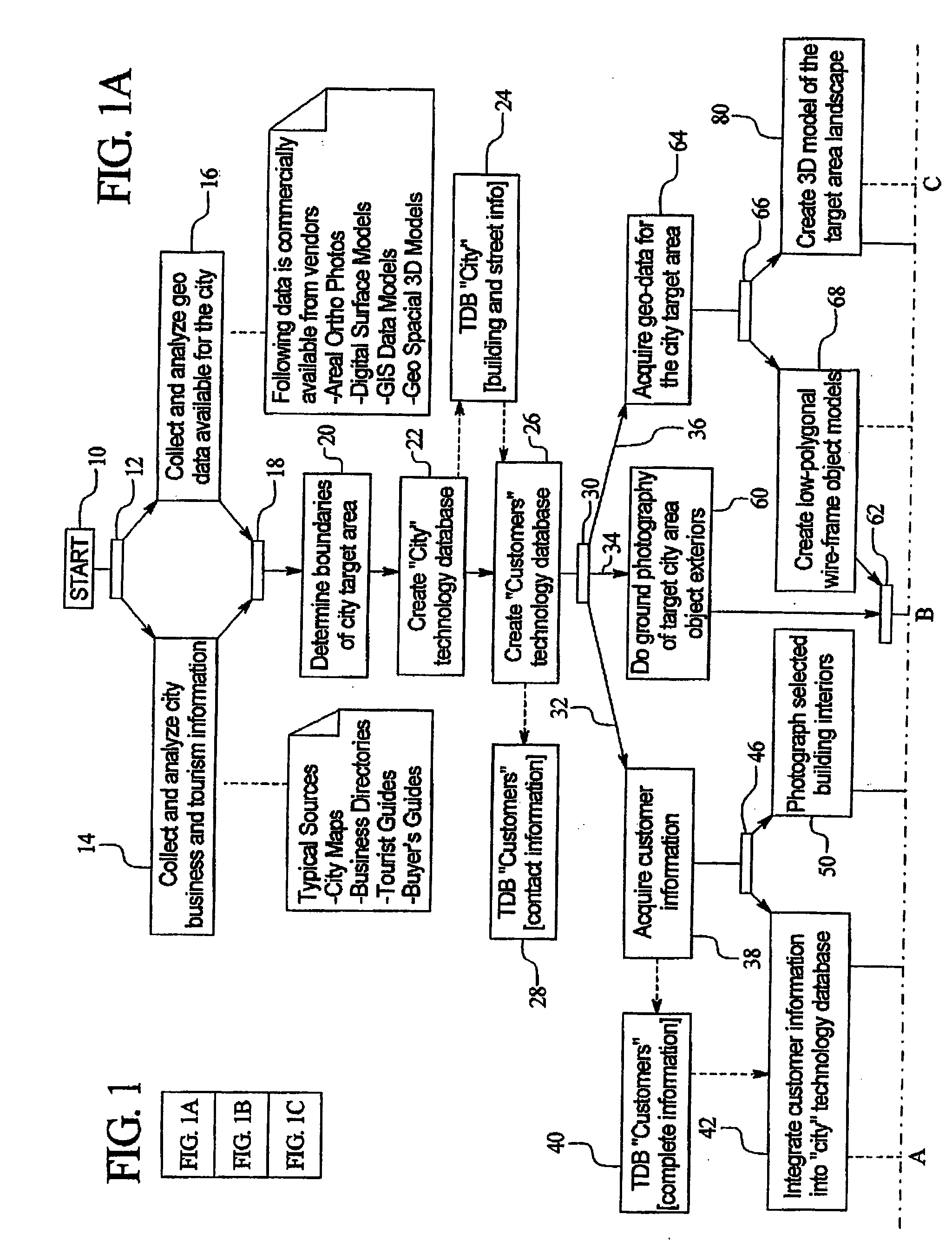

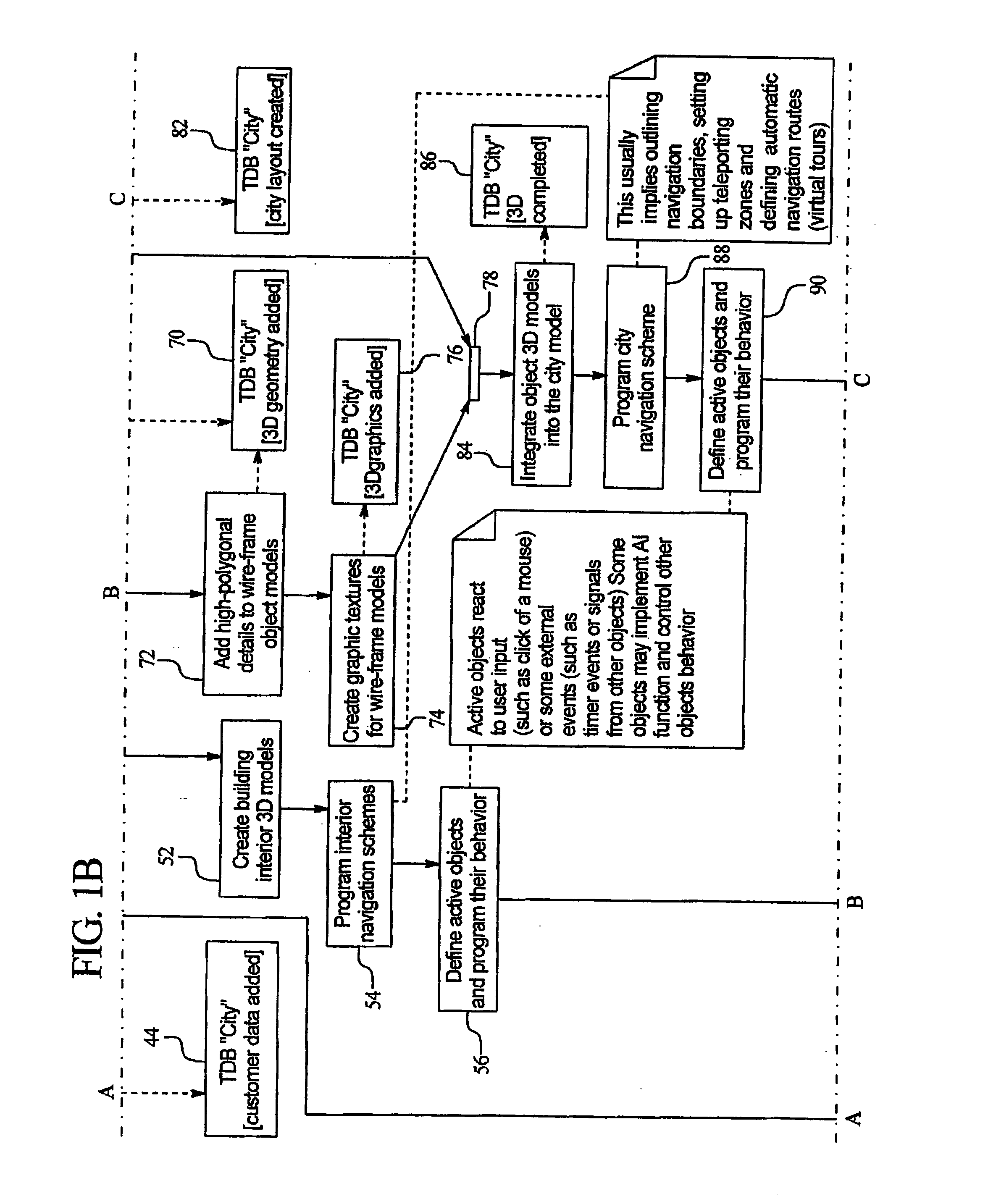

System and method for minimizing the amount of data necessary to create a virtual three-dimensional environment

InactiveUS20050128212A1Minimized data collectionQuantity minimizationCathode-ray tube indicatorsSpecific program execution arrangementsGraphics3D city models

A system and method for minimizing the amount of photographic data to be collected to reconstruct a model of a three-dimensional object such as a building. In one embodiment a systematic process is used to collect survey and detailed photographic data from designated facades and architectural components of the facades to be processed into graphical tiles. The graphical tiles are textured or coated onto a three-dimensional wireframe model of the building. In one embodiment, the amount of photographic data to be collected is based on the footprint of the building, the height of the building and the number of unique facades and architectural details on the facades. In one embodiment, photographic data of the objects surrounding the building is also collected for modeling with the building. The virtual three-dimensional building models can be incorporated into the virtual three-dimensional city model which is a realistically accurate depiction of a city environment including all the details of an actual city.

Owner:XDYNE

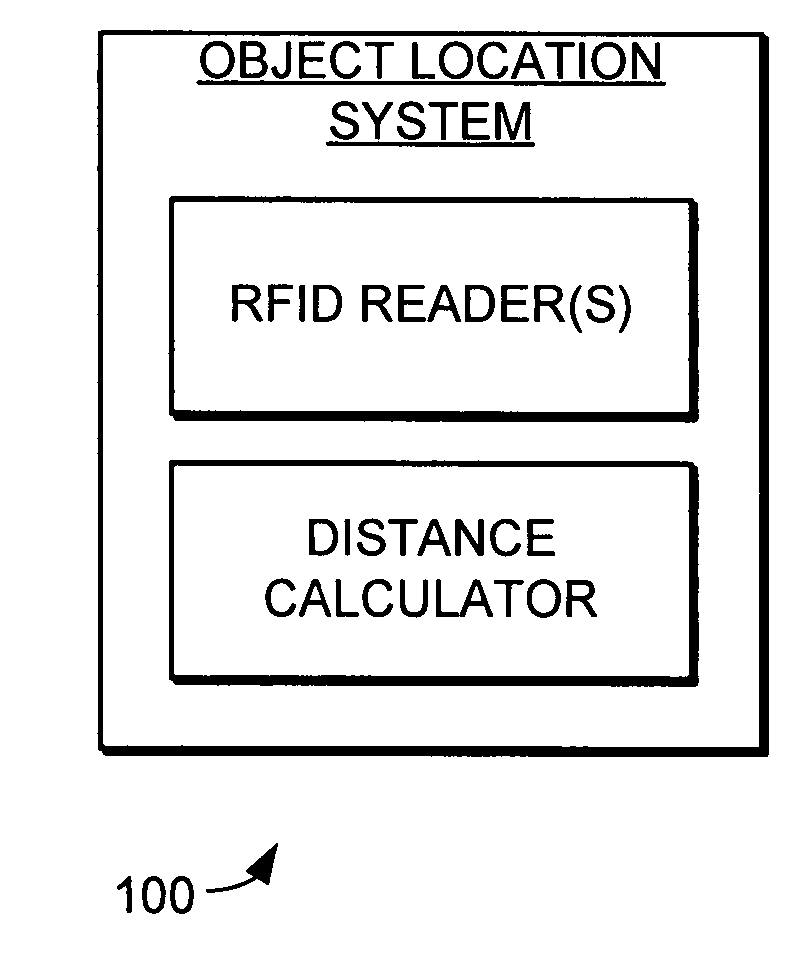

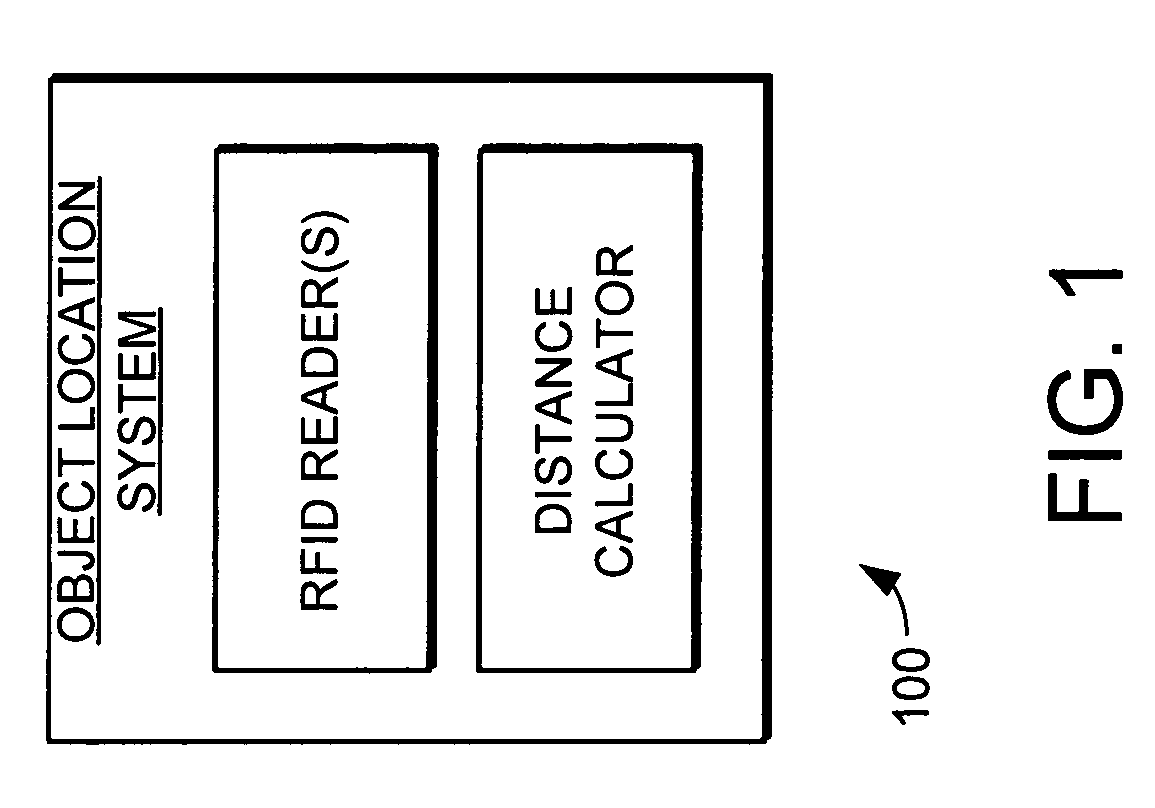

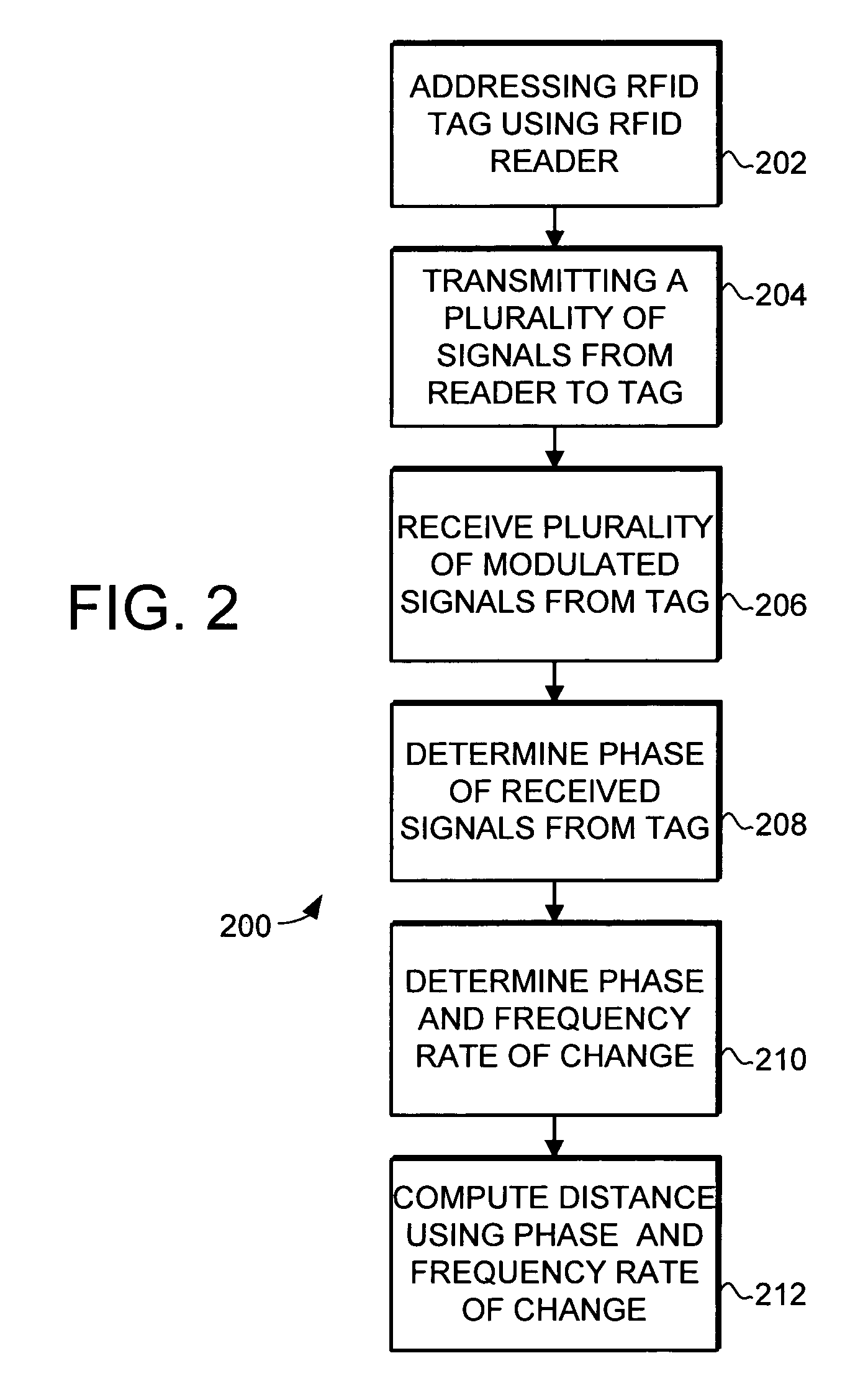

Object location system and method using RFID

ActiveUS7119738B2Efficiently and accurately determineEfficiently determinedElectric/electromagnetic visible signallingBurglar alarm by hand-portable articles removalFundamental frequencyComputer science

A system and method is provided for locating objects using RFID tags. The system and method uses an RFID reader and a distance calculator to efficiently and accurately determine the location of objects that include an RFID tag. The RFID reader transmits a plurality of signals to the RFID tag, with the plurality of signals having different fundamental frequencies. In response, the RFID tag backscatter modulates the plurality of transmitted signals to create a plurality of backscatter modulated signals. The RFID reader receives and demodulates the plurality of backscatter modulated signals. The distance calculator determines the phase of the plurality of backscatter modulated signals and determines a rate of change of the phase in the backscatter modulated signals with respect to the rate of change in the fundamental frequency of the transmitted signals and uses this information to calculate the distance to the RFID tag.

Owner:SYMBOL TECH LLC

Profile and consent accrual

ActiveUS20050193093A1Enhance information sharingLess laborDigital data processing detailsDigital data protectionInternet privacyPersonal details

Consent management between a client and a network server. In response to a request for consent, a central server determines if requested user information is included in a user profile associated with a user and if the user has granted consent to share the requested user information. A user interface is provided to the user via a browser of the client to collect the requested user information that is not included in the user profile and the consent to share the requested user information from the user. After receiving the user information provided by the user via the user interface, the service provided by the network server is allowed access to the received user information, and the central server updates the user profile. Other aspects of the invention are directed to computer-readable media for use with profile and consent accrual.

Owner:MICROSOFT TECH LICENSING LLC

Method and apparatus for codon determining

InactiveUS7702464B1Efficiently determinedEfficient identificationBiological testingSequence analysisClient-sideData needs

Computer processing methods and / or systems for minimizing and / or optimizing data strings in accordance with rules and options. Minimized data strings can represent data sequences important in certain biologic analyses and / or syntheses. In specific embodiments, a request is generated by a user at a client system and received by a server system. The server system accesses initial data indicated or provided by the client system. The server system then performs an analysis to minimize the data needed for further reactions. In specific embodiments, a server can use proprietary methods or data at the server side while protecting those proprietary methods and data from access by the client system.

Owner:CODEXIS MAYFLOWER HLDG LLC

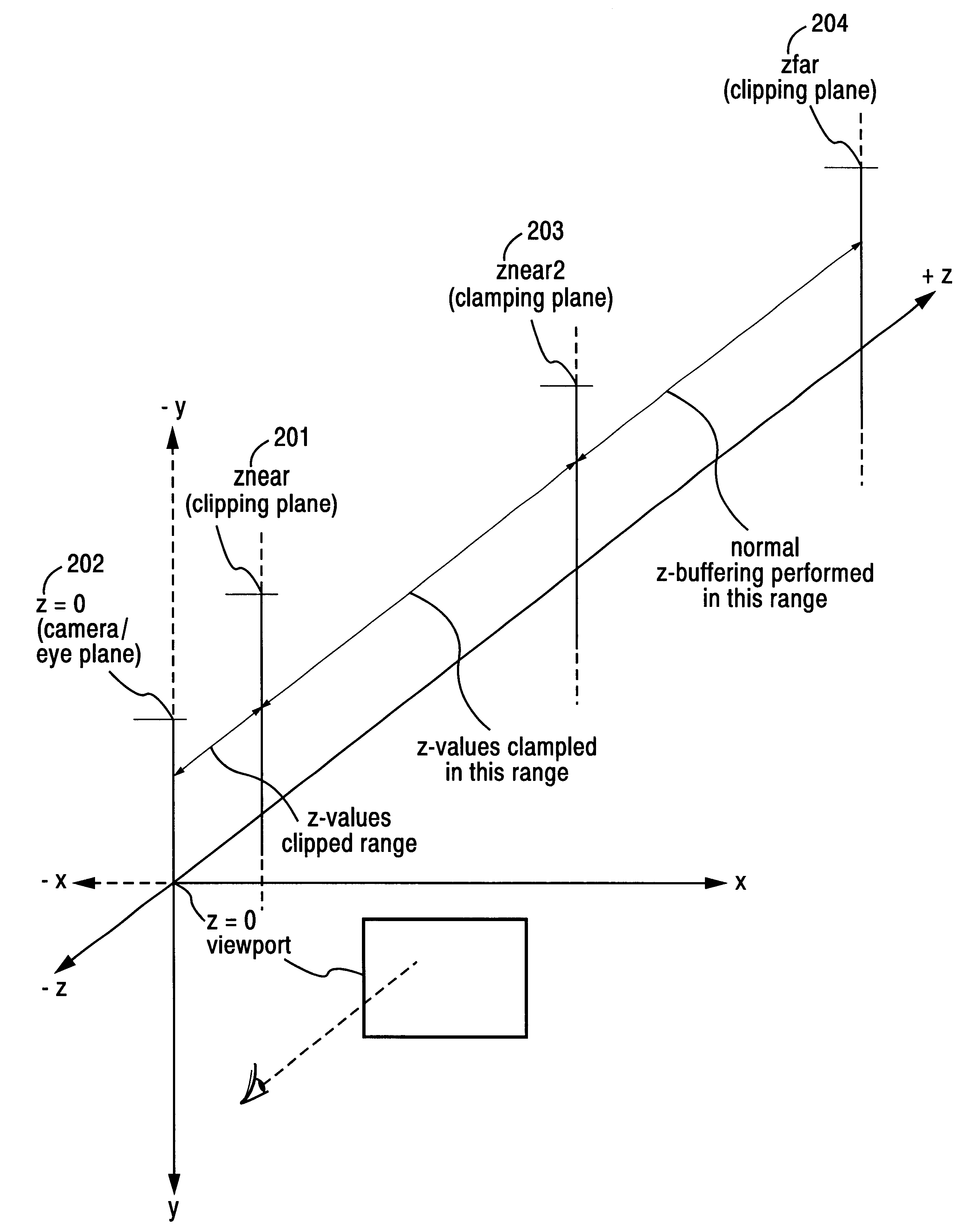

3D graphics rendering system for performing Z value clamping in near-Z range to maximize scene resolution of visually important Z components

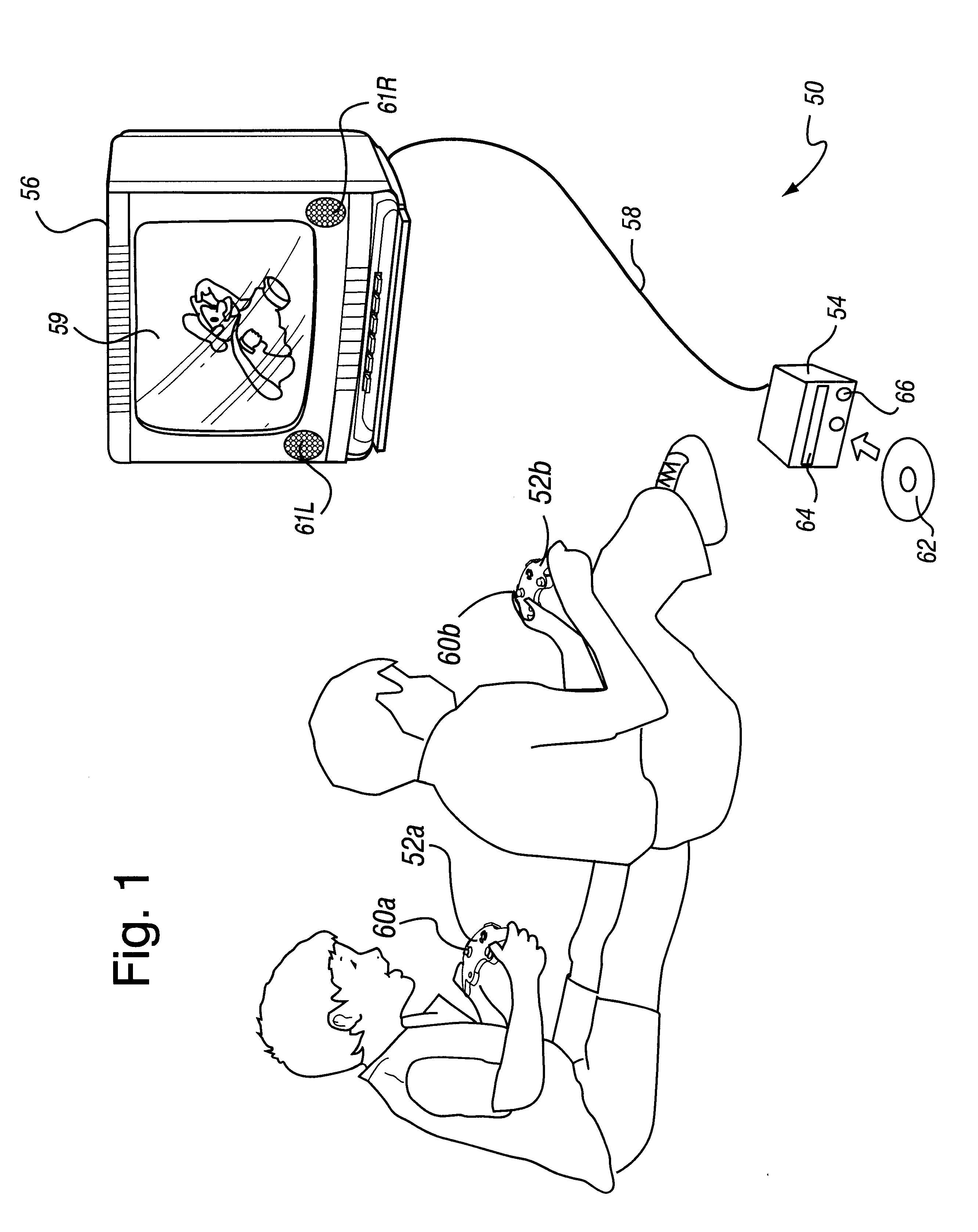

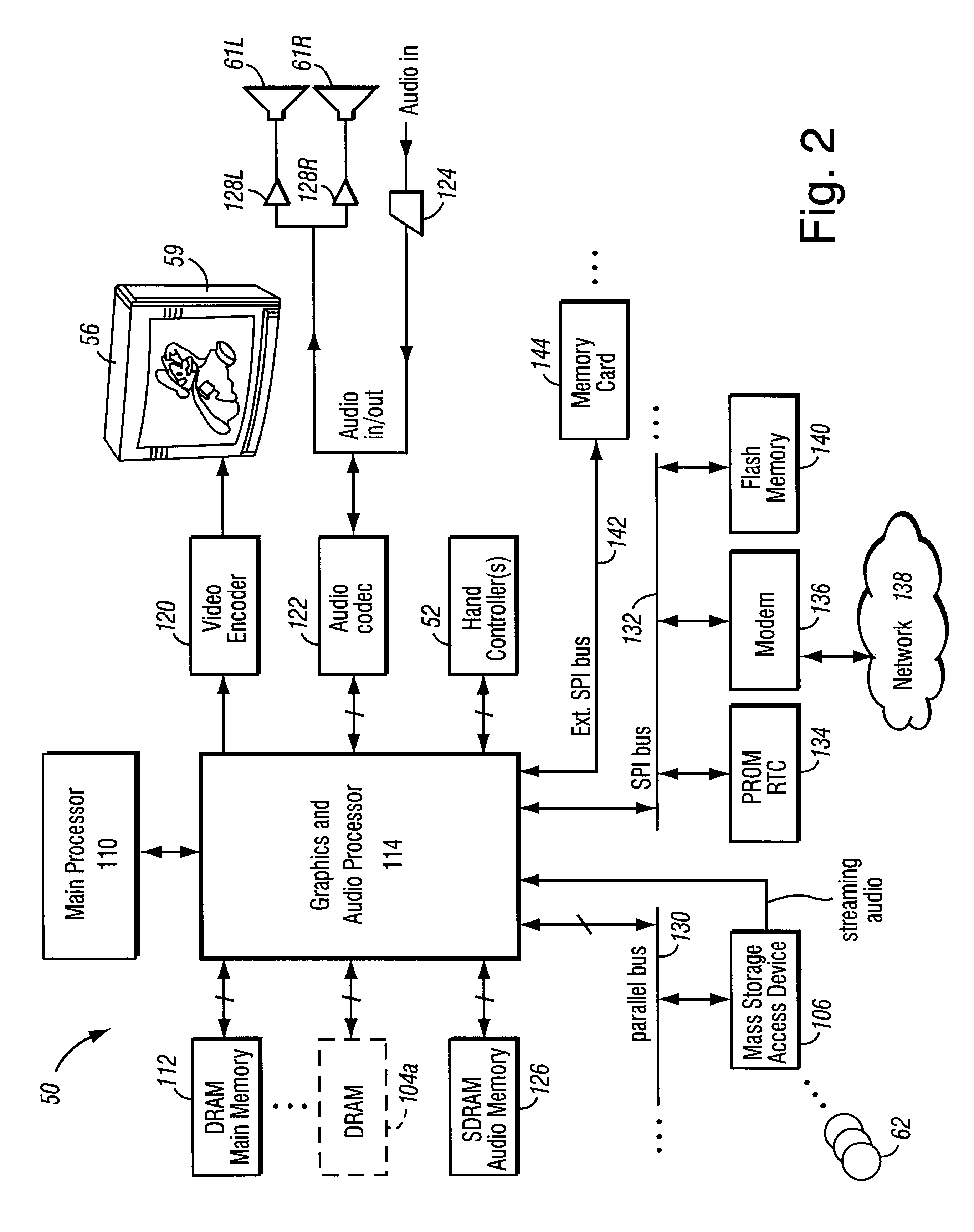

InactiveUS6618048B1Improve precisionAvoid undesirable visual artifactCathode-ray tube indicatorsProcessor architectures/configurationSurround soundImage resolution

A graphics system including a custom graphics and audio processor produces exciting 2D and 3D graphics and surround sound. The system includes a graphics and audio processor including a 3D graphics pipeline and an audio digital signal processor. The graphics pipeline performs Z-buffering and optionally provides memory efficient full scene anti-aliasing (FSAA). When the anti-aliasing rendering mode is selected, Z value bit compression is performed to more efficiently make use of the available Z buffer memory. A Z-clamping arrangement is used to improve the precision of visually important Z components by clamping Z values to zero of pixels that fall within a predetermined Z-axis range near the Z=0 eye / camera (viewport) plane. This allows a Z-clipping plane to be used very close to the eye / camera plane--to avoid undesirable visual artifacts produced when objects rendered near to the eye / camera plane are clipped--while preserving Z value precision for the remaining depth of the scene. In an example implementation, a Z value compression circuit provided in the graphics pipeline is enhanced to effectuate Z-clamping within the predetermined range of Z values. The enhanced circuitry includes an adder for left-shifting an input Z value one or more bits prior to compression and gates for masking out the most significant non-zero shifted bits to zero.

Owner:NINTENDO CO LTD

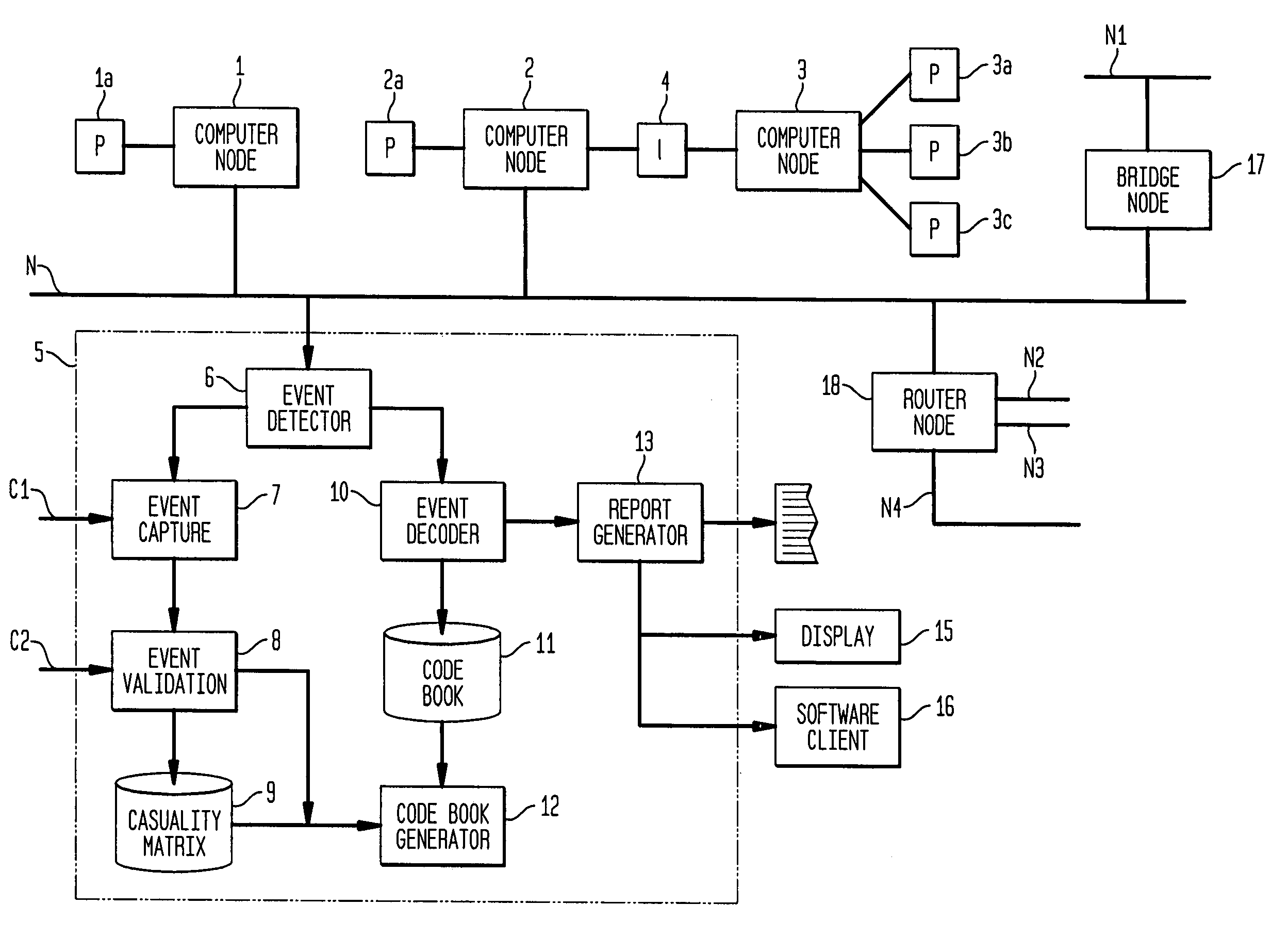

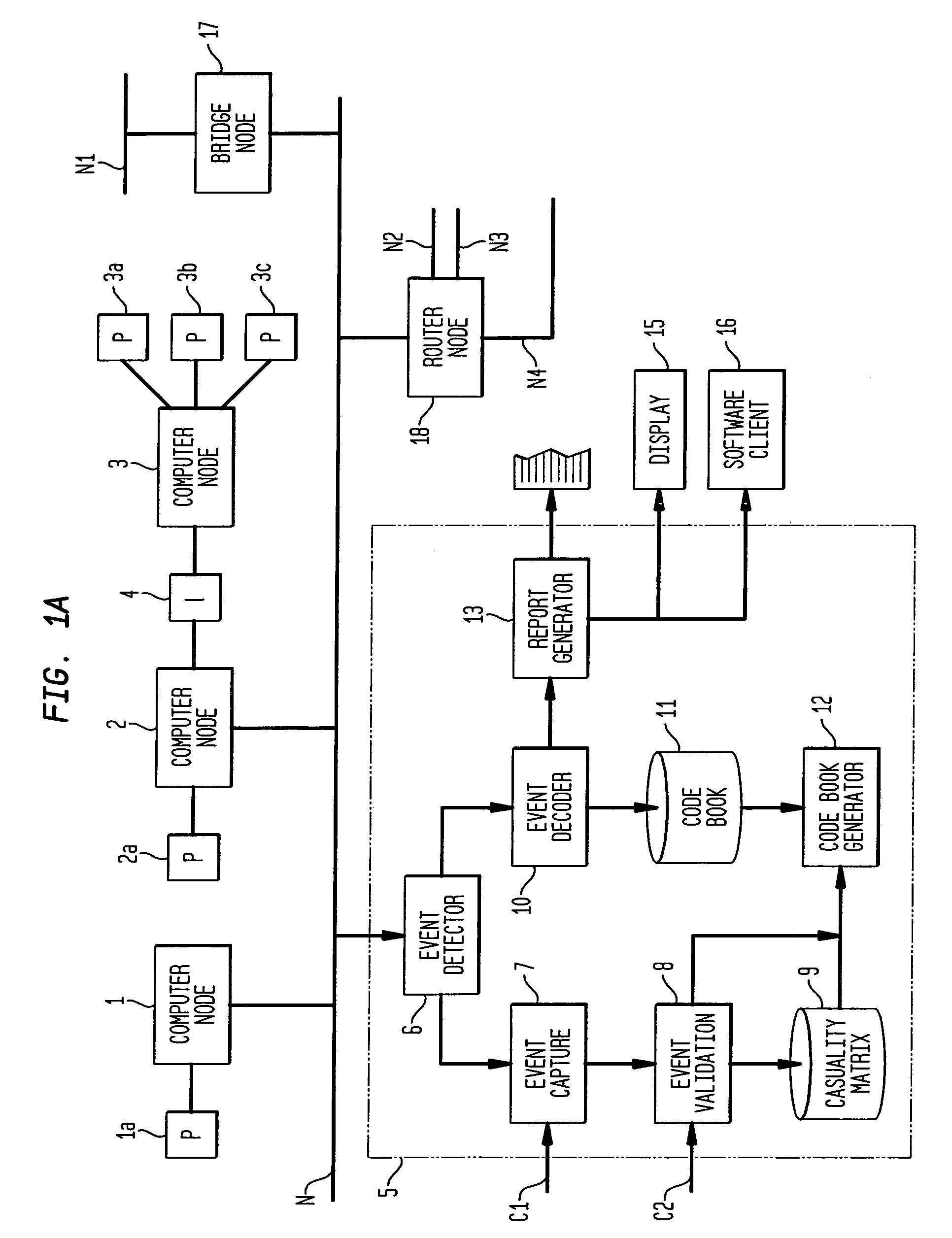

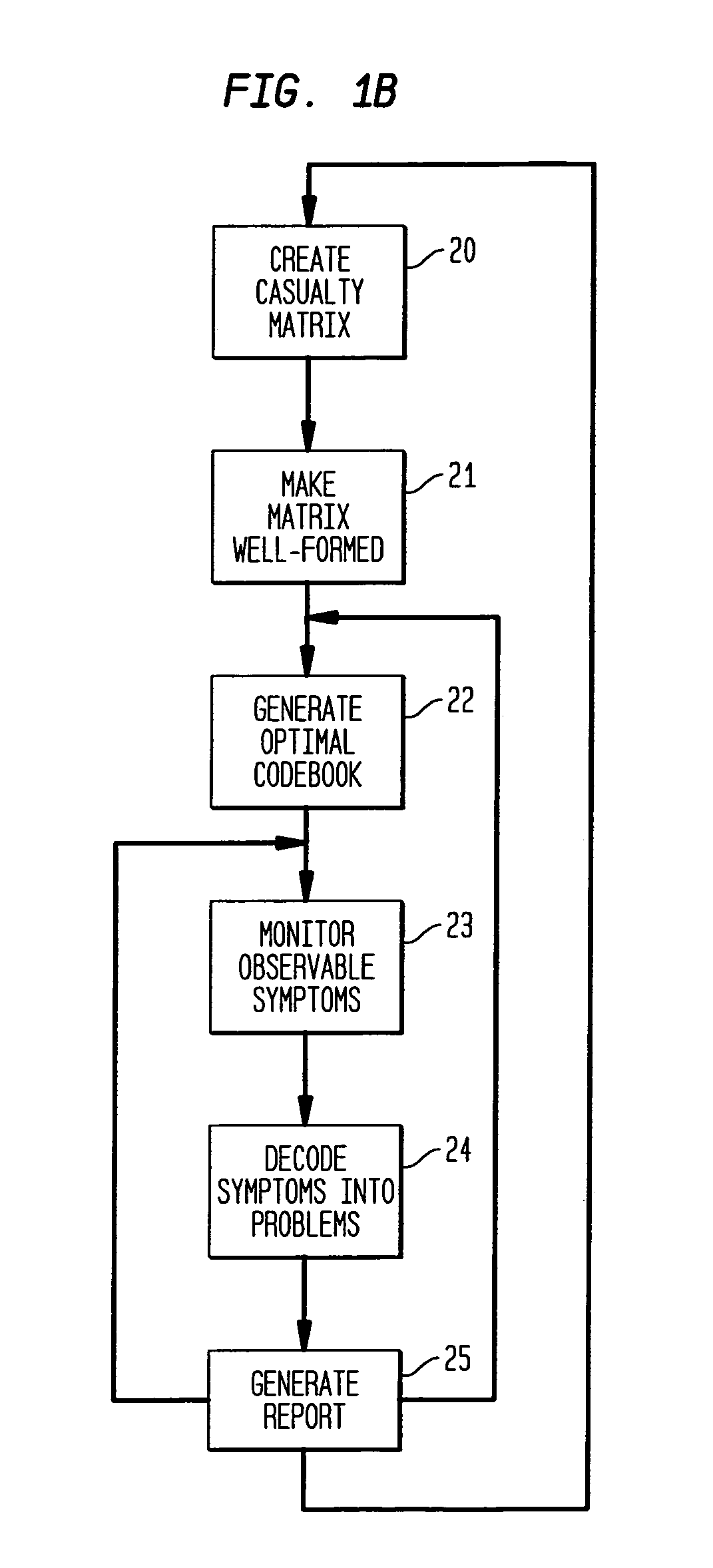

Apparatus and method for event correlation and problem reporting

InactiveUS7107185B1Effective monitoringImprove efficiencyNuclear monitoringDigital computer detailsComplex systemComputer science

A computer implemented method on a computer readable media is provided for determining the source of a problem in a complex system of managed components based upon symptoms. The problem source identification process is split into different activities. Explicit configuration non-specific representations of types of managed components, their problems, symptoms and the relations along which the problems or symptoms propagate are created that can be manipulated by executable computer code. A data structure is produced for determining the source of a problem by combining one or more of the representations based on information of specific instances of managed components in the system. Computer code is then executed which uses the data structure to determine the source of the problem from one or more symptoms.

Owner:VMWARE INC

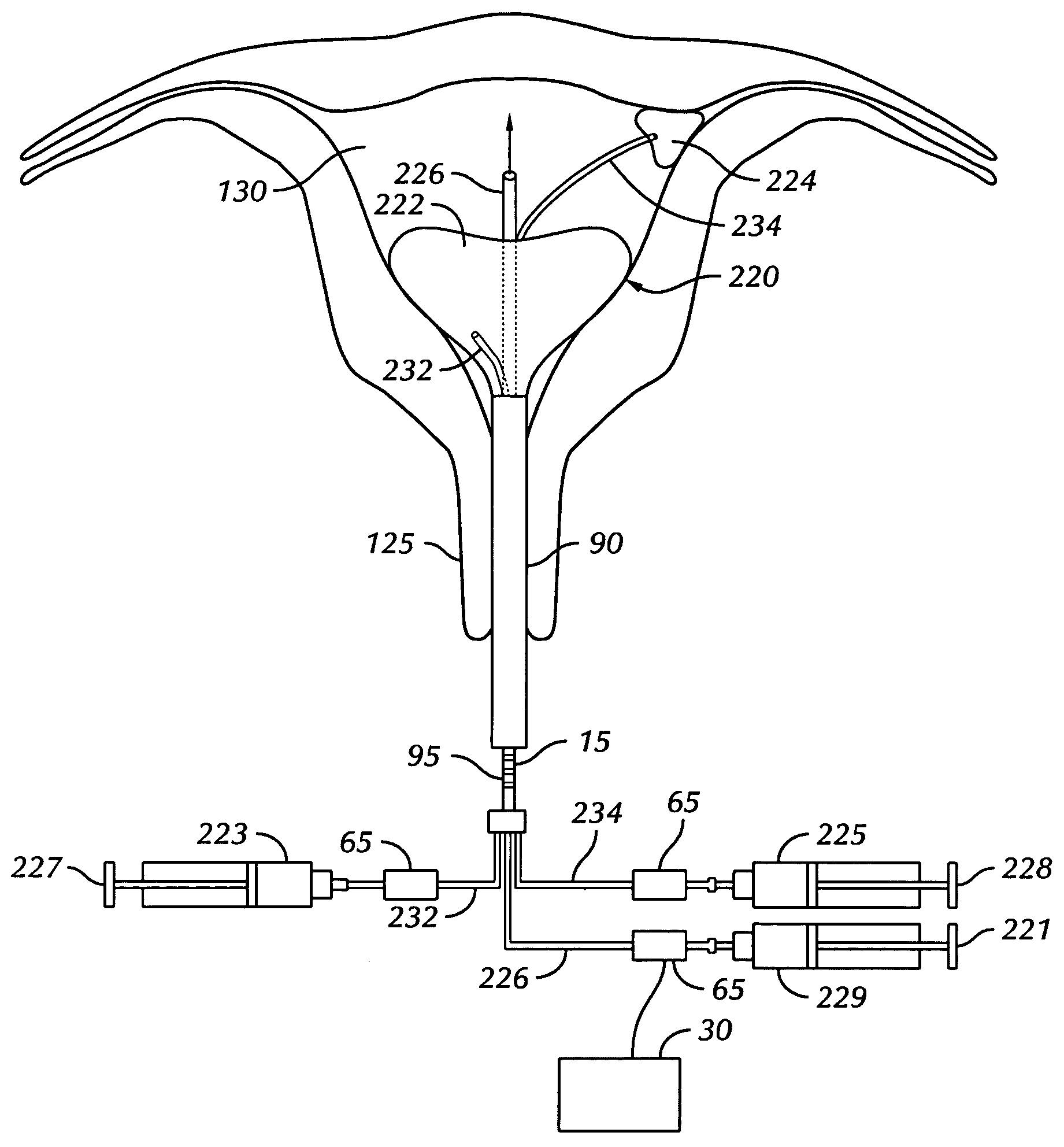

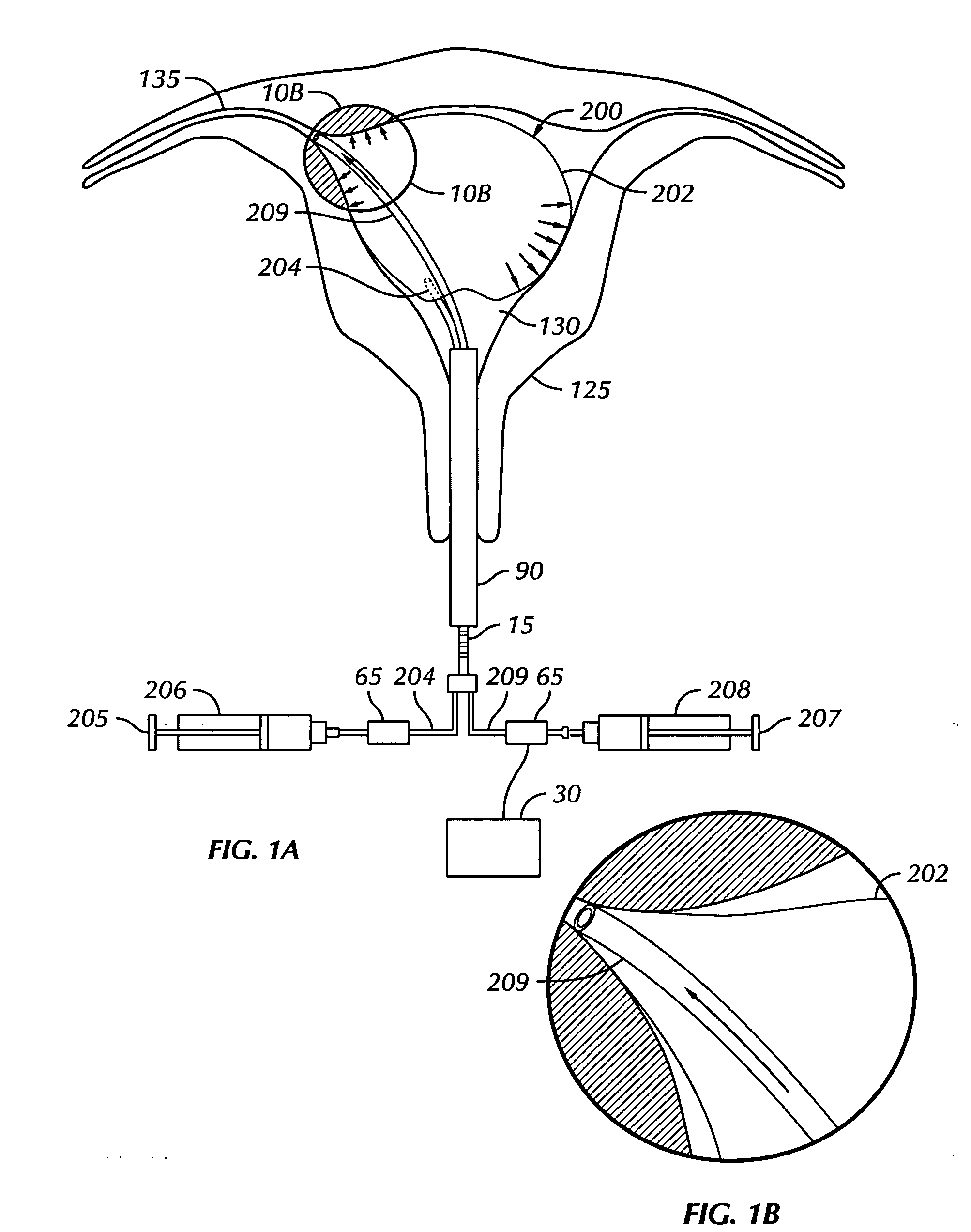

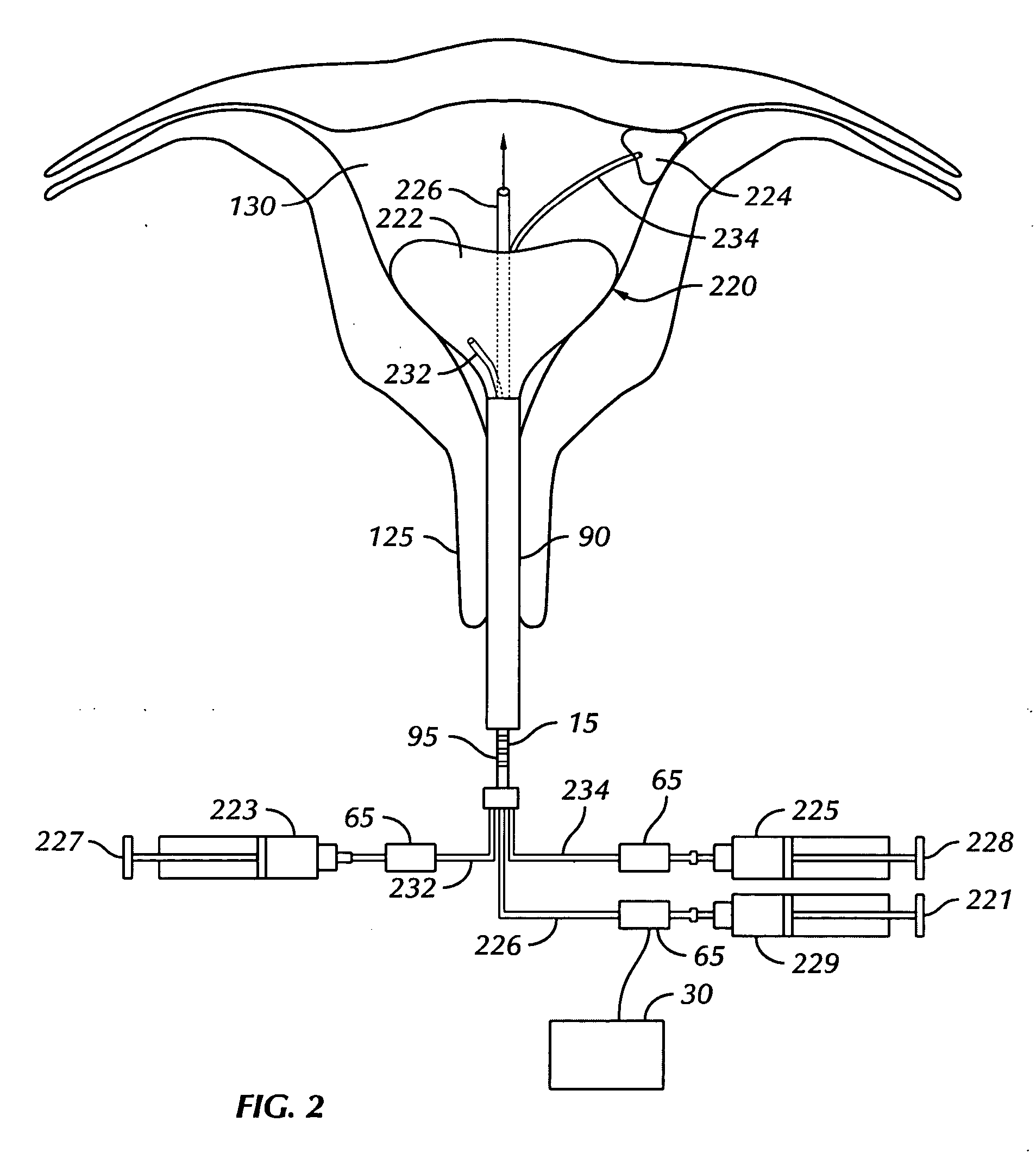

Apparatus and method for selectably treating a fallopian tube

InactiveUS20050240211A1Simple and inexpensiveEfficiently determinedStentsBalloon catheterUterine cavityFallopian tube

The present invention is an apparatus and methods for selectably assessing a fallopian tube. The apparatus is a device that allows for treatment and / or the assessment of the patency of each fallopian tube independently by isolating at least one cornual regions from the uterine cavity. The method of the present invention is based on use of the device and allows for assessment of fallopian tube patency without the use of dyes of x-rays.

Owner:NOVOMEDICS

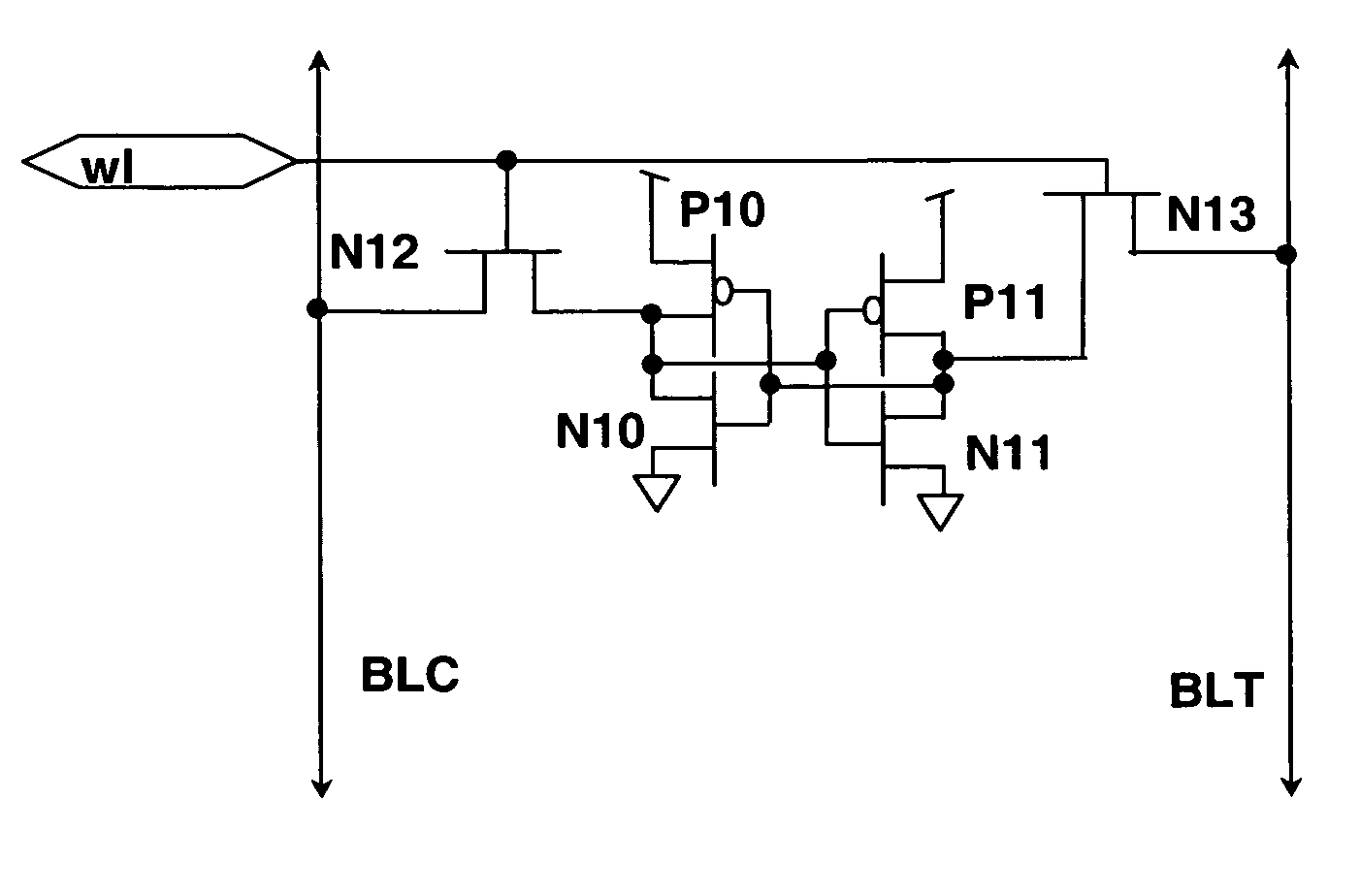

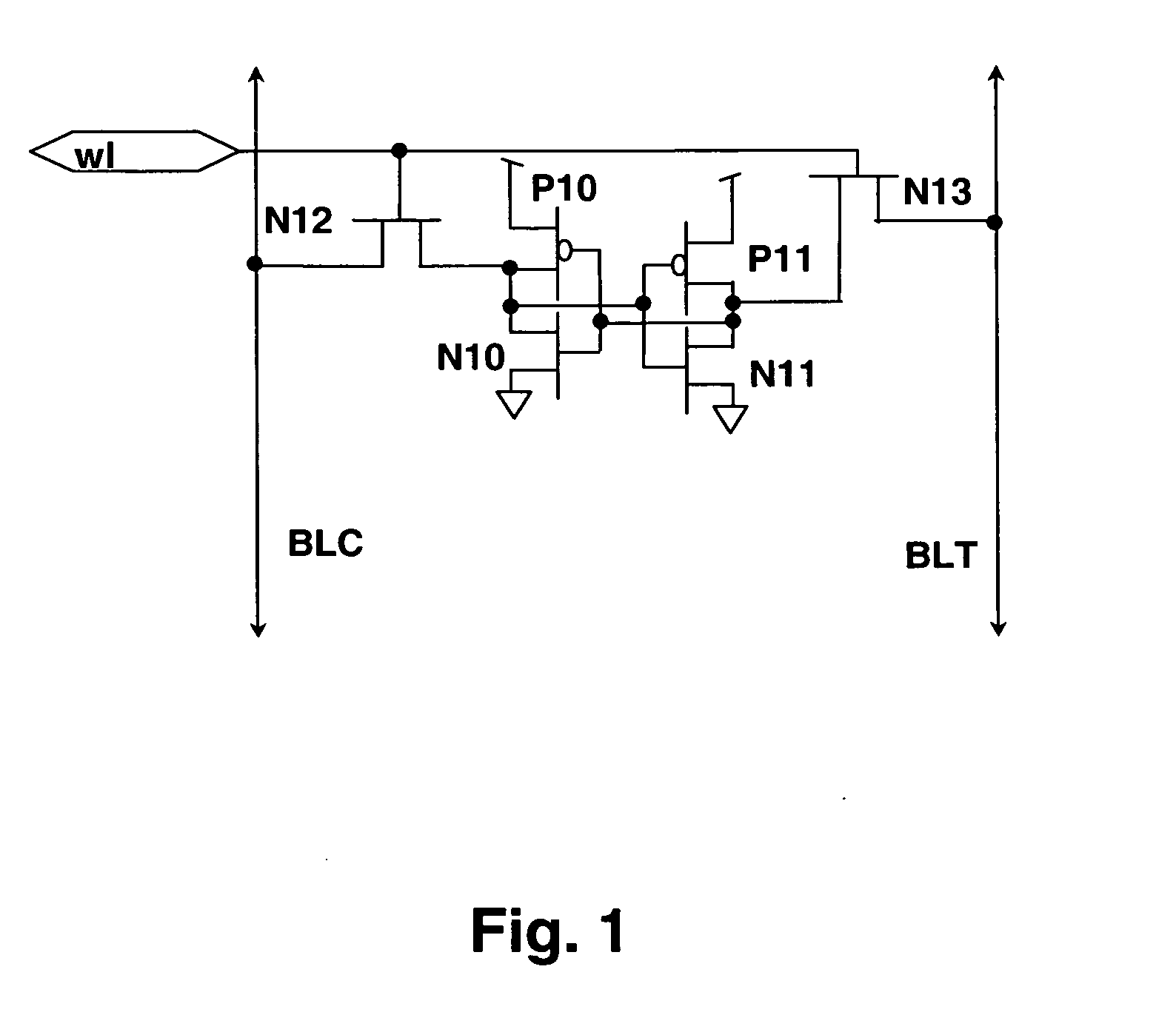

Efficient method and computer program for modeling and improving static memory performance across process variations and environmental conditions

InactiveUS20060203581A1Simple designImprove device yieldDigital storageCAD circuit designParallel computingCell design

An efficient method and computer program for modeling and improving stating memory performance across process variations and environmental conditions provides a mechanism for raising the performance of memory arrays beyond present levels / yields. Statistical (Monte-Carlo) analyses of subsets of circuit parameters are performed for each of several memory performance variables and then sensitivities of each performance variable to 15 each of the circuit parameters are determined. The memory cell design parameters and / or operating conditions of the memory cells are then adjusted in conformity with the sensitivities, resulting in improved memory yield and / or performance. Once a performance level is attained, the sensitivities can then be used to alter the probability distributions of the performance variables to achieve a higher yield. Multiple cell designs can be compared for performance, yield and sensitivity of performance variables to circuit parameters over particular environmental conditions in order to select the best cell design.

Owner:GLOBALFOUNDRIES INC

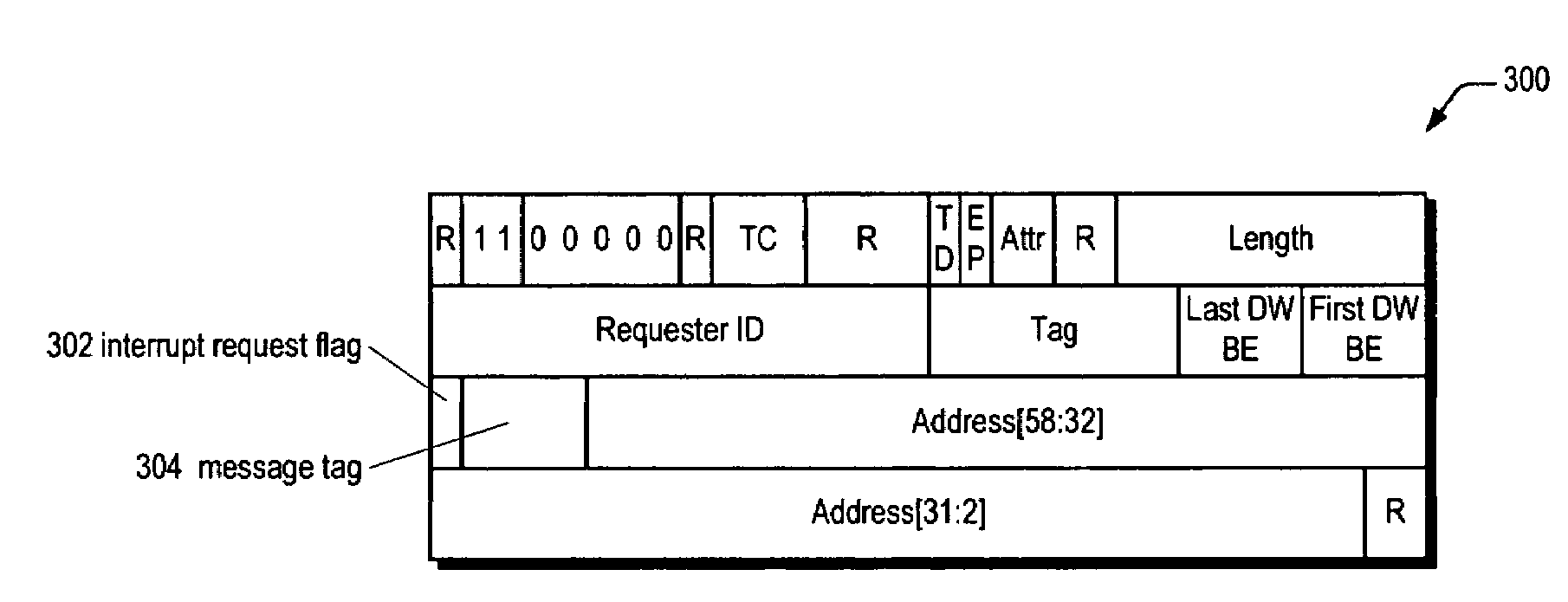

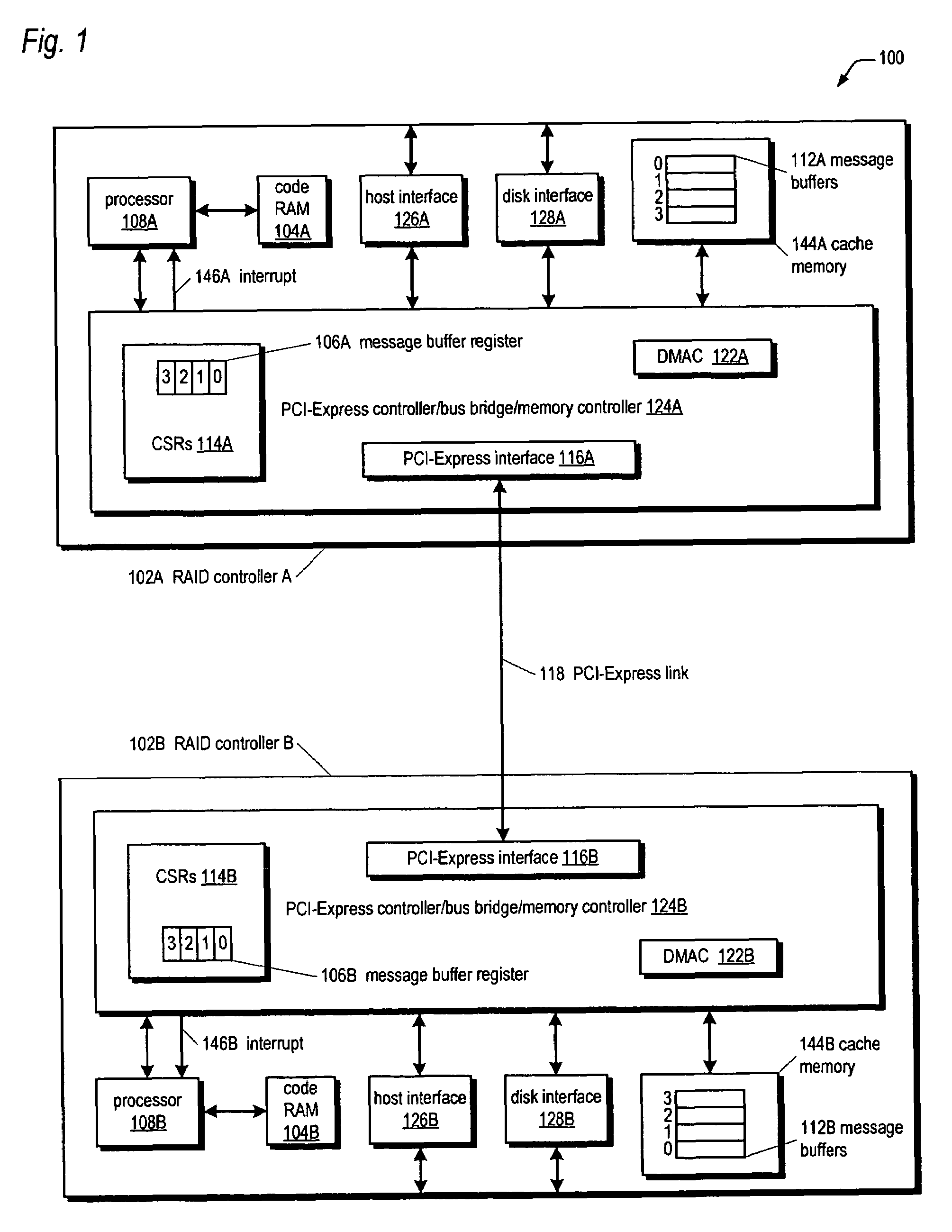

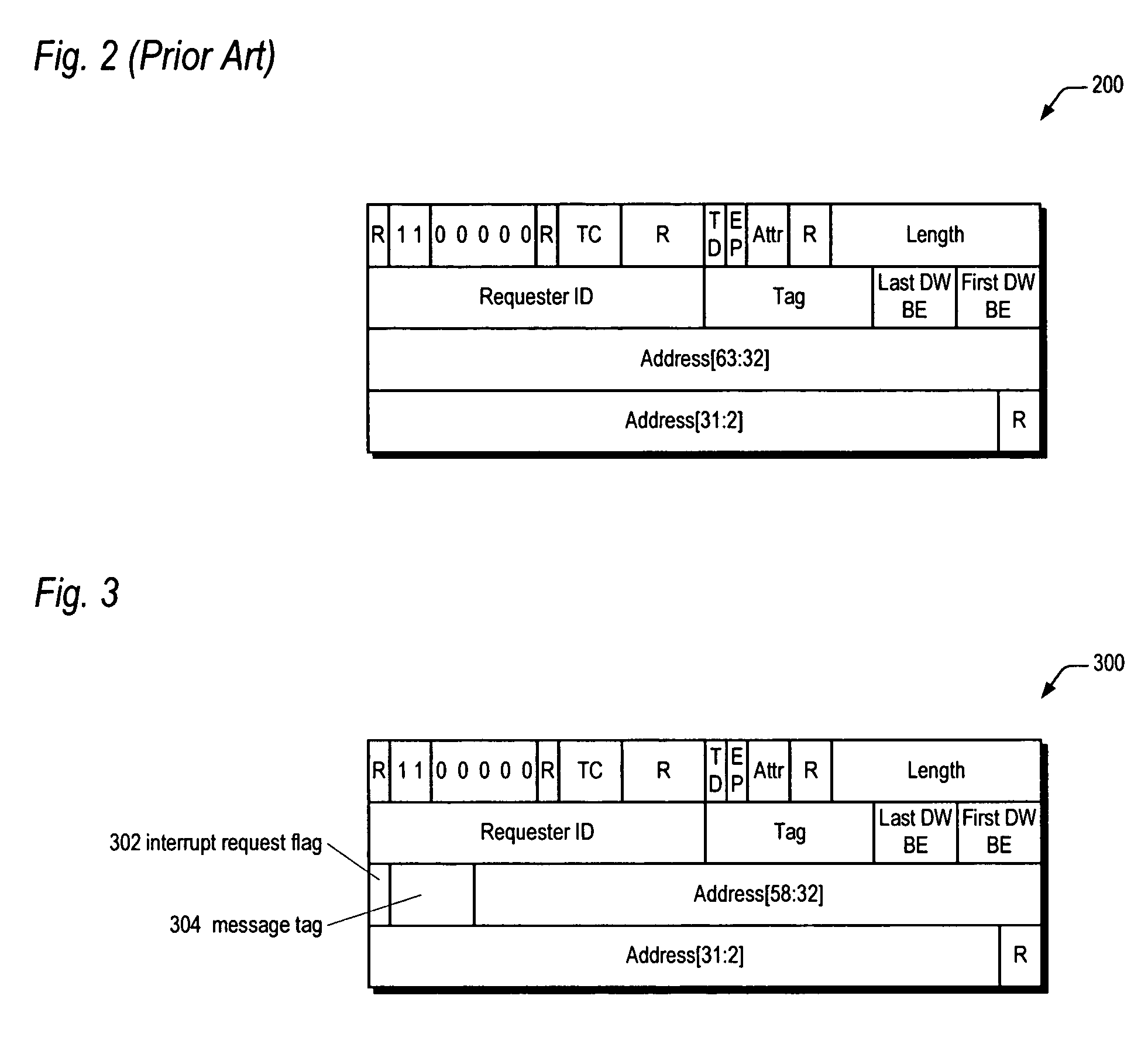

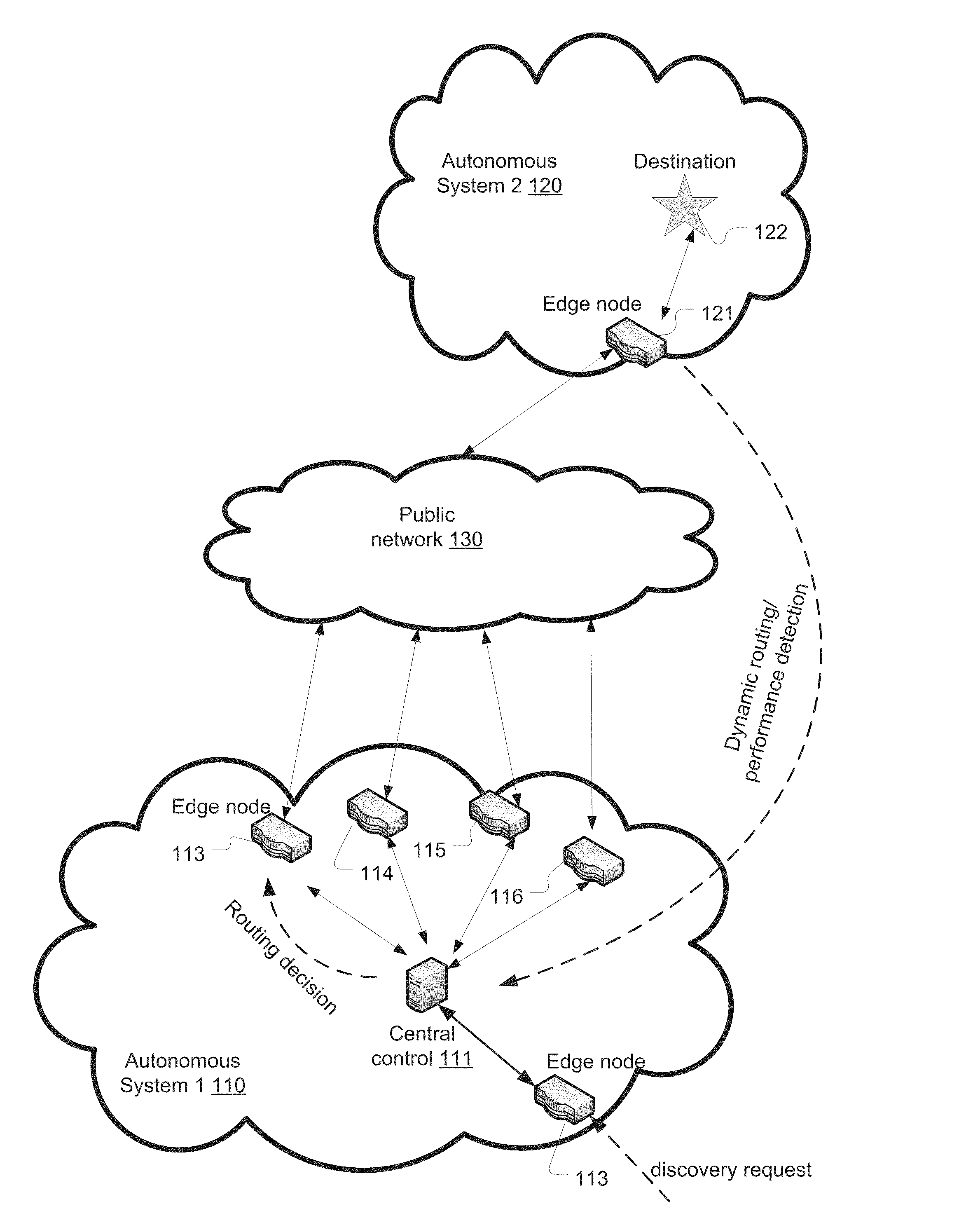

Method for efficient inter-processor communication in an active-active RAID system using PCI-express links

ActiveUS7315911B2Efficiently determinedError detection/correctionMemory systemsRAIDProcessor register

A fault-tolerant RAID system is disclosed. The system includes redundant RAID controllers coupled by a PCI-Express link. When a PCI-Express controller of one of the RAID controllers receives a PCI-Express memory write request transaction layer packet (TLP), it interprets a predetermined bit in the header as an interrupt request flag, rather than as its standard function specified by the PCI-Express specification. If the flag is set, the PCI-Express controller interrupts the processor after storing the message in the payload at the specified memory location. In one embodiment, an unused upper address bit in the header is used as the interrupt request flag. Additionally, unused predetermined bits in the TLP header are used as a message tag to indicate one of a plurality of message buffers on the receiving RAID controller into which the message has been written. The PCI-Express controller sets a corresponding bit in a register to indicate which message buffer was written.

Owner:DOT HILL SYST

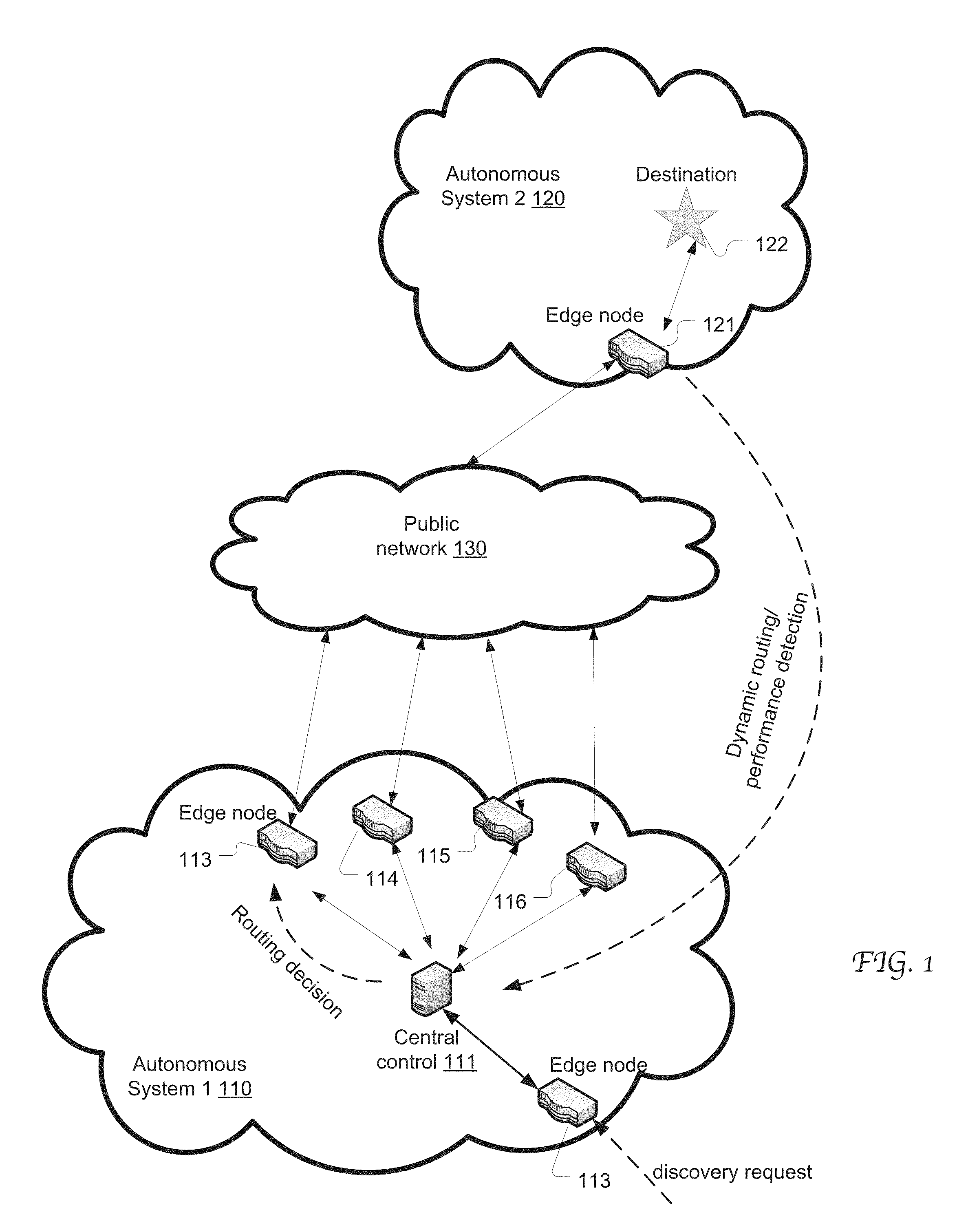

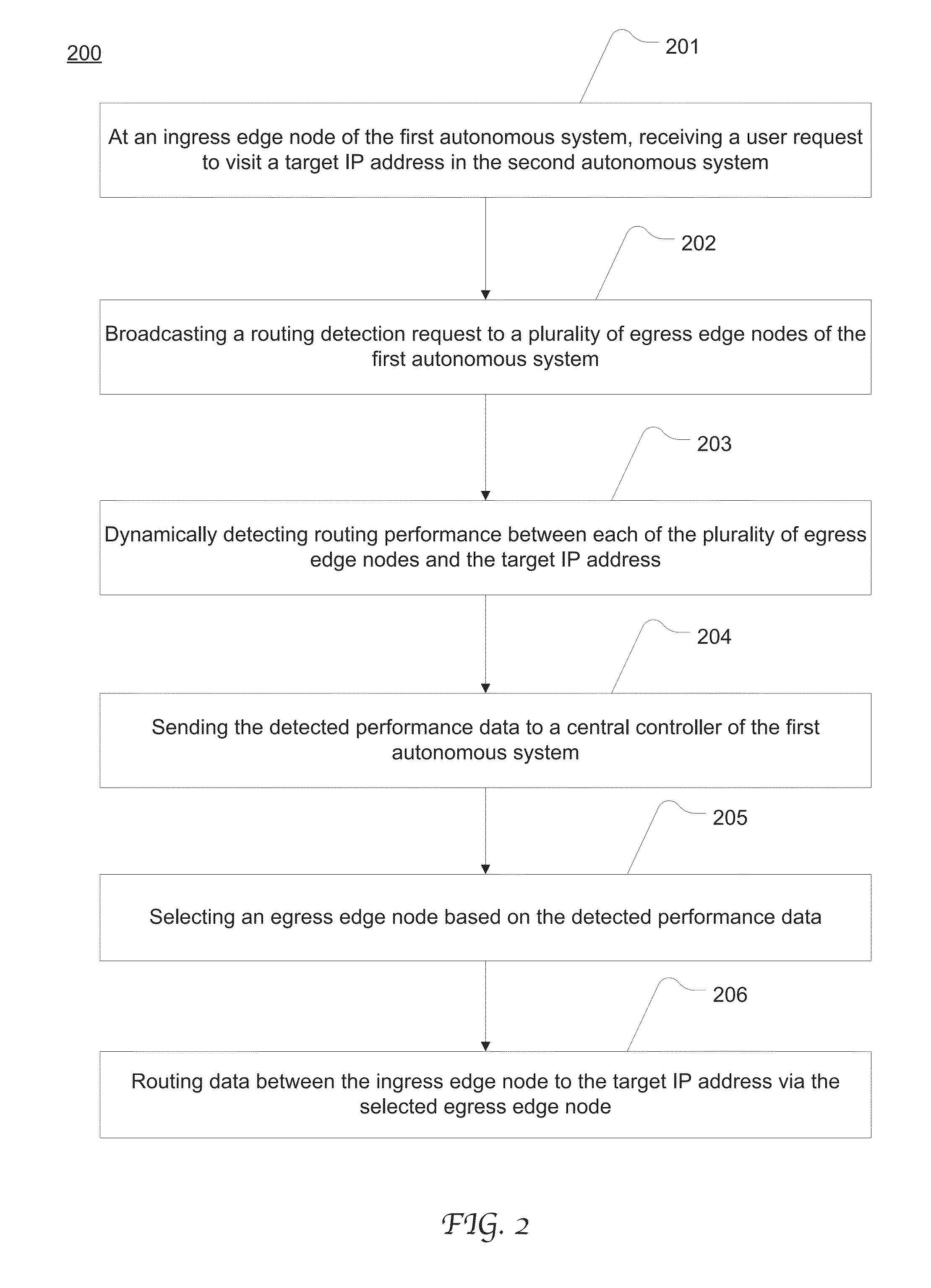

Data routing across multiple autonomous network systems

ActiveUS20160261493A1Facilitate transmissionQuality of serviceData switching networksEvaluation resultNetworked system

Systems and methods providing a route optimization mechanism for transmitting data traffic across different autonomous systems based on real-time route performance detection. Regarding a request for routing data between a source node that is coupled to a first autonomous system and a destination node located in a second autonomous system, each of a plurality of edge nodes in the first autonomous system operates to detect and evaluate real-time route performance. The evaluation results are compared and used to select an edge node and an associated link for transporting data between the source node and the destination node. The route optimization mechanism can be adopted in an SDN-based or other virtual network autonomous system.

Owner:ALGOBLU HLDG

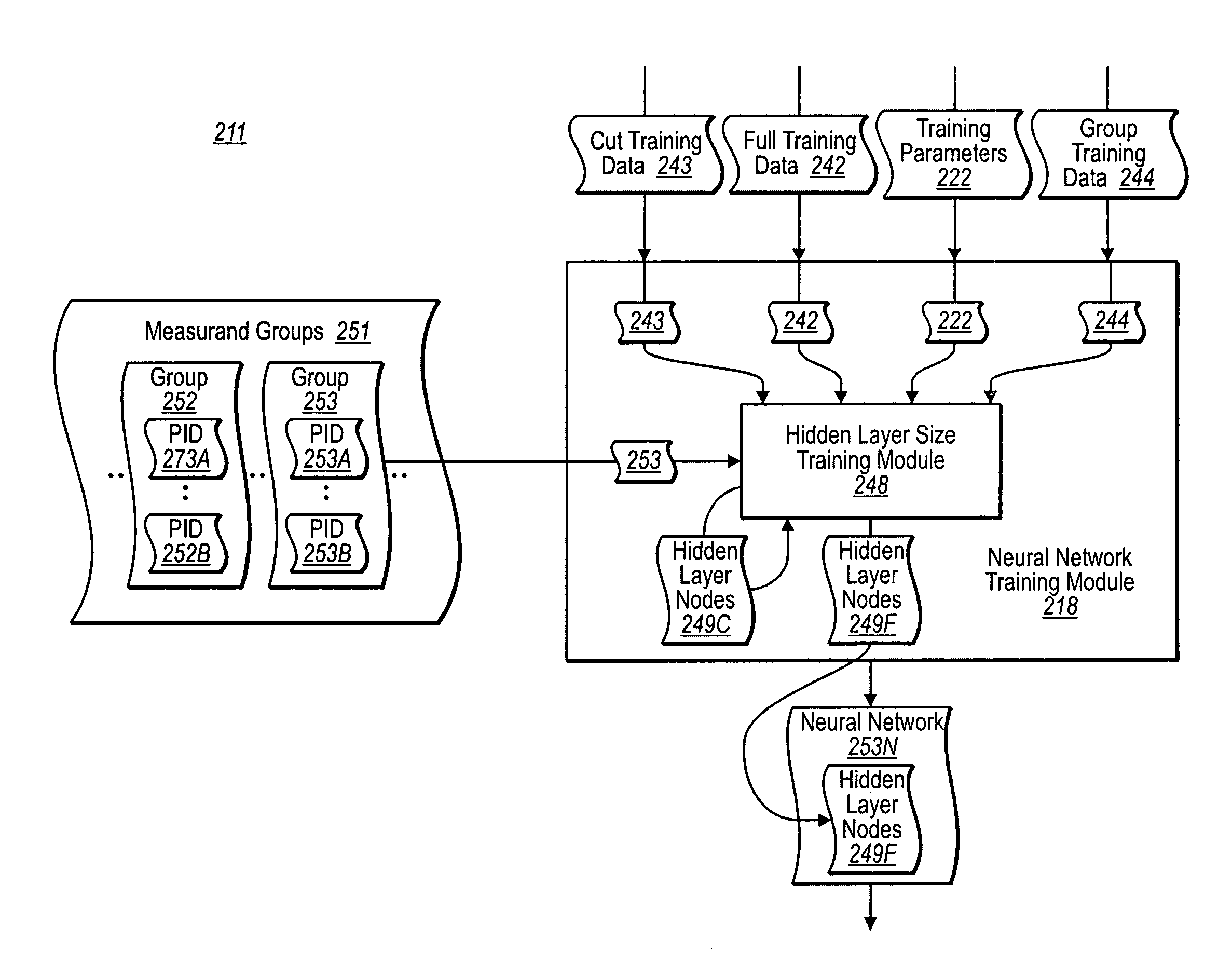

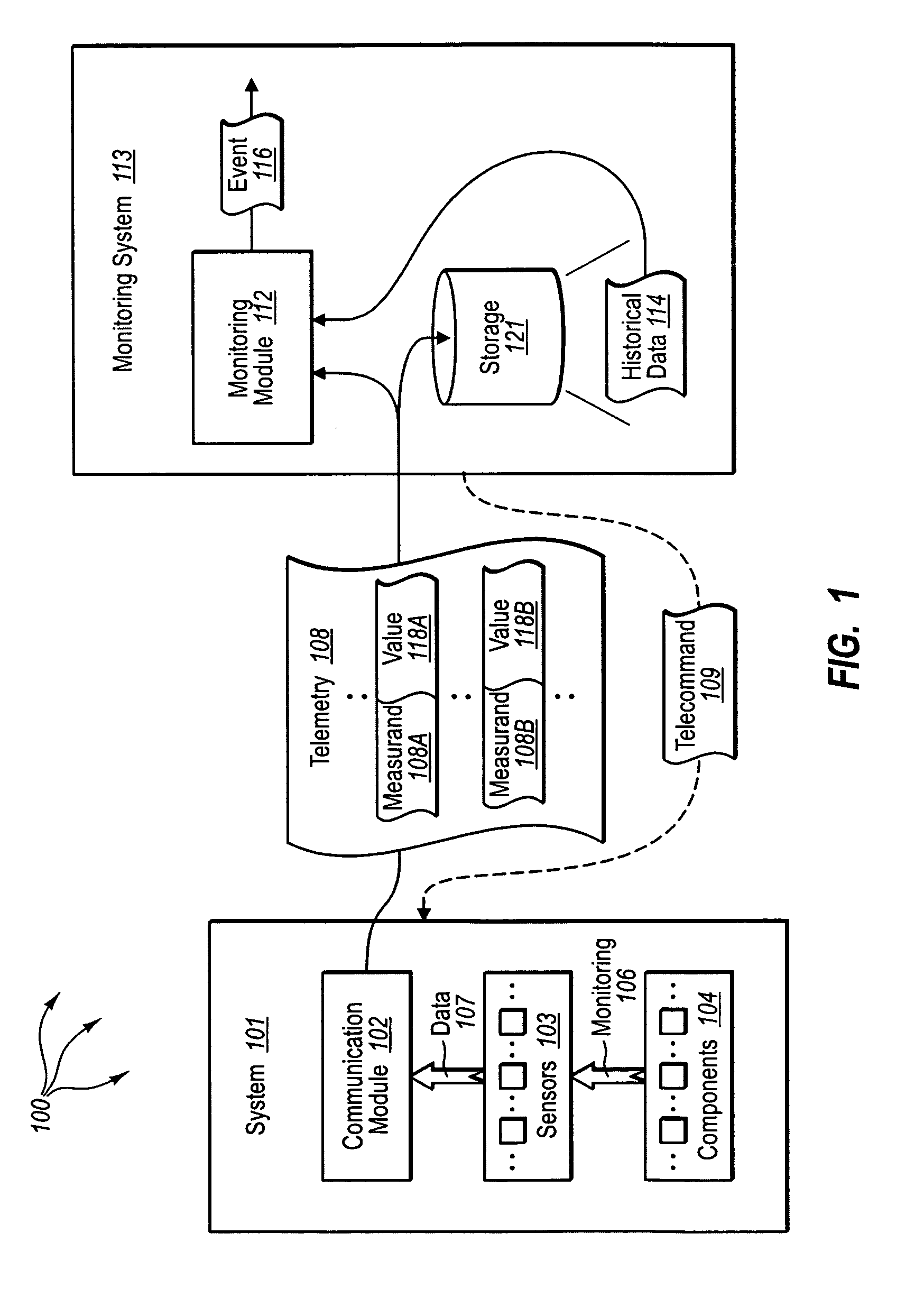

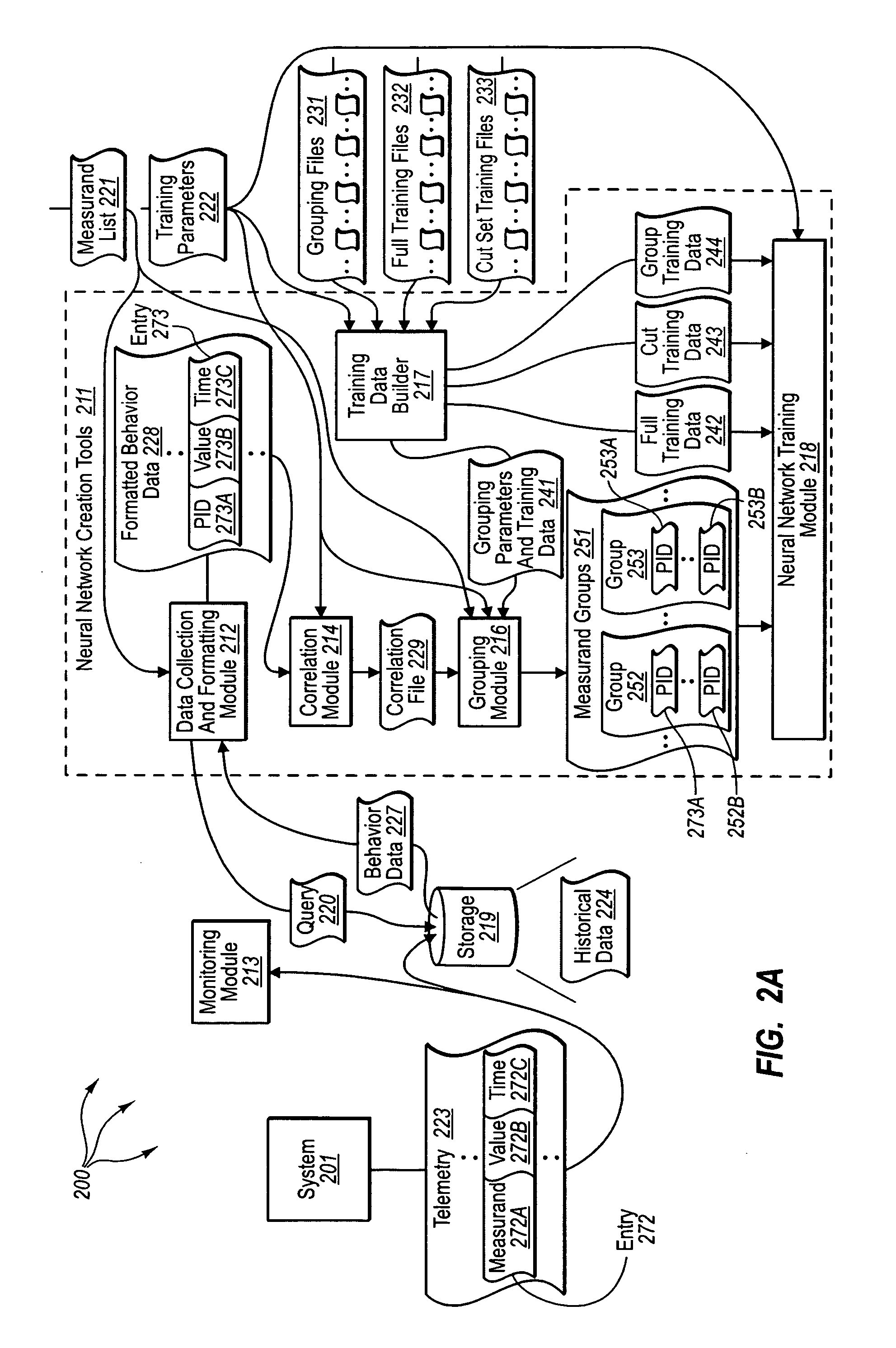

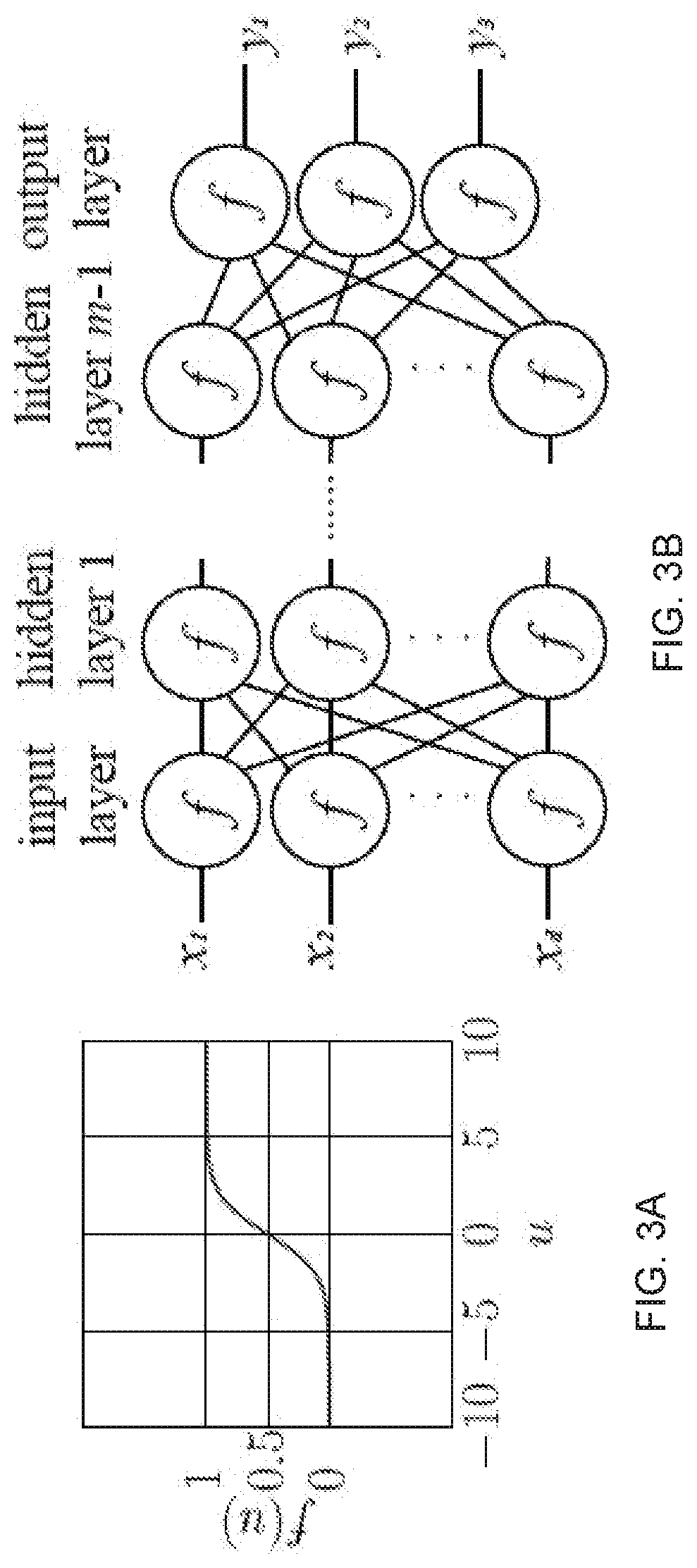

Detecting, classifying, and tracking abnormal data in a data stream

ActiveUS8306931B1Efficiently determineEfficiently determinedDigital computer detailsDigital dataNeural net architectureSelf adaptive

The present invention extends to methods, systems, and computer program products for detecting, classifying, and tracking abnormal data in a data stream. Embodiments include an integrated set of algorithms that enable an analyst to detect, characterize, and track abnormalities in real-time data streams based upon historical data labeled as predominantly normal or abnormal. Embodiments of the invention can detect, identify relevant historical contextual similarity, and fuse unexpected and unknown abnormal signatures with other possibly related sensor and source information. The number, size, and connections of the neural networks all automatically adapted to the data. Further, adaption appropriately and automatically integrates unknown and known abnormal signature training within one neural network architecture solution automatically. Algorithms and neural networks architecture are data driven, resulting more affordable processing. Expert knowledge can be incorporated to enhance the process, but sufficient performance is achievable without any system domain or neural networks expertise.

Owner:DATA FUSION & NEURAL NETWORKS

Systems and methods for refining a decision-making process via executable sequences

InactiveUS7080066B1Rich environmentEfficient leveragingResourcesSpecial data processing applicationsDrill downData mining

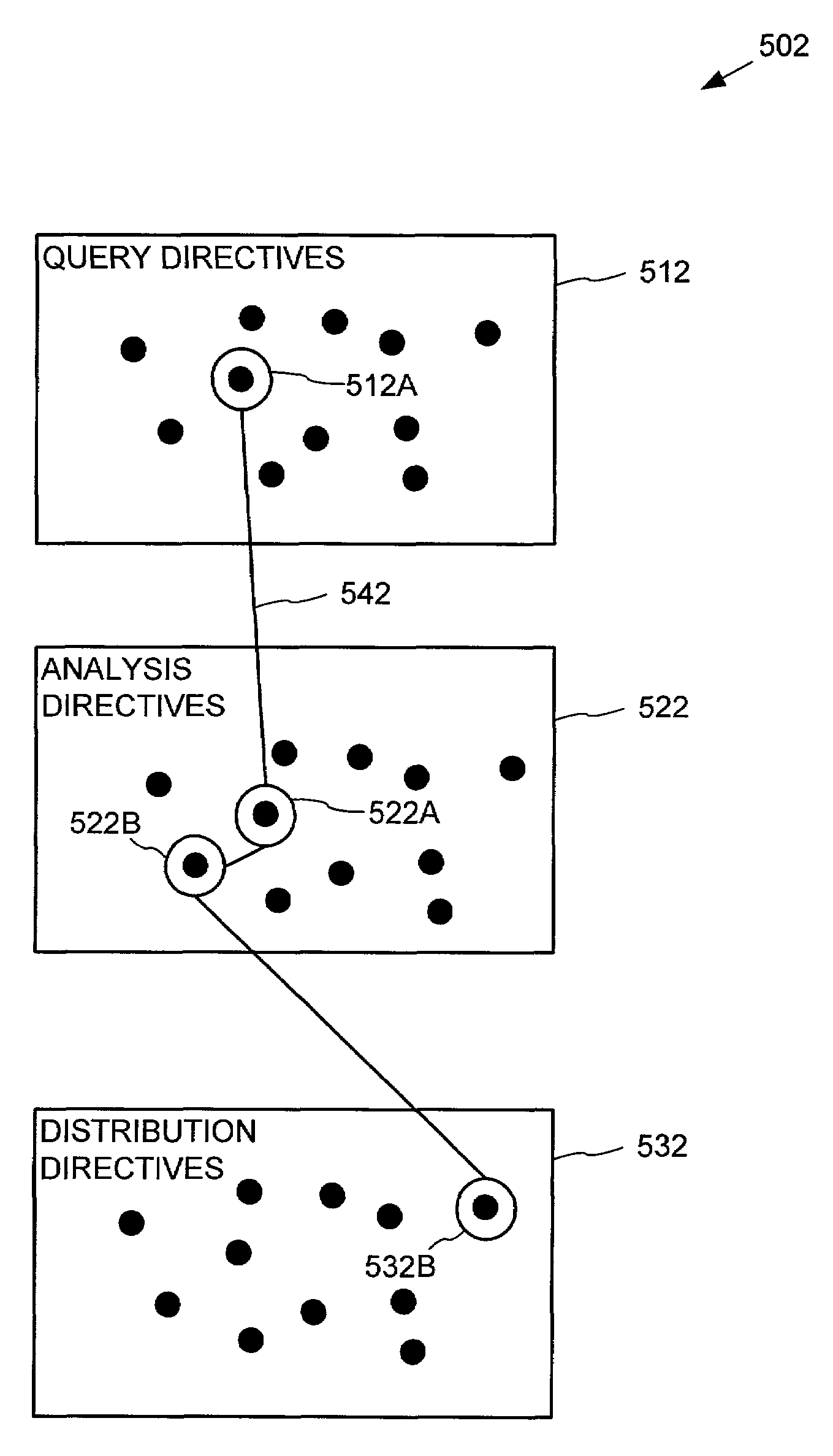

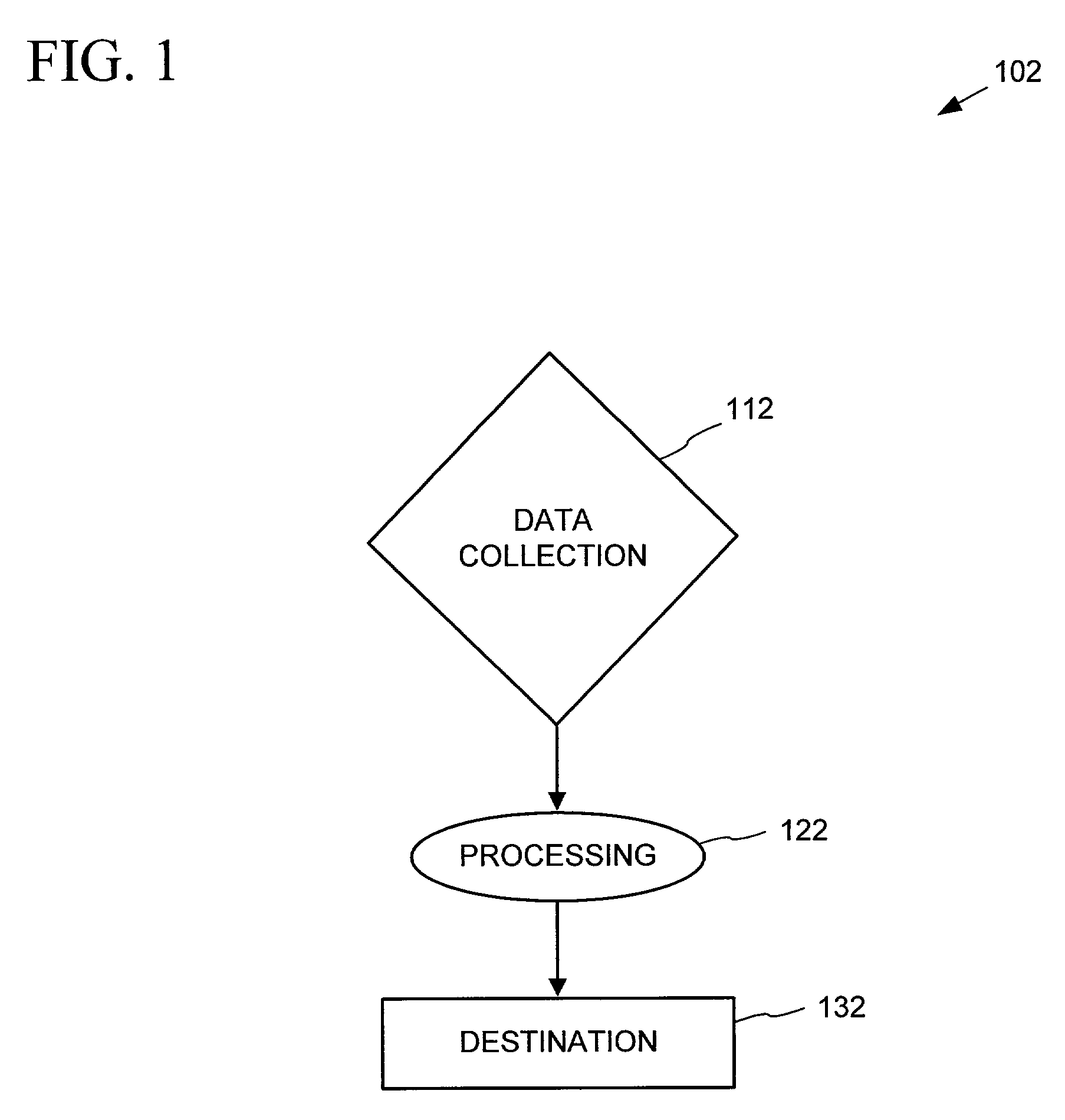

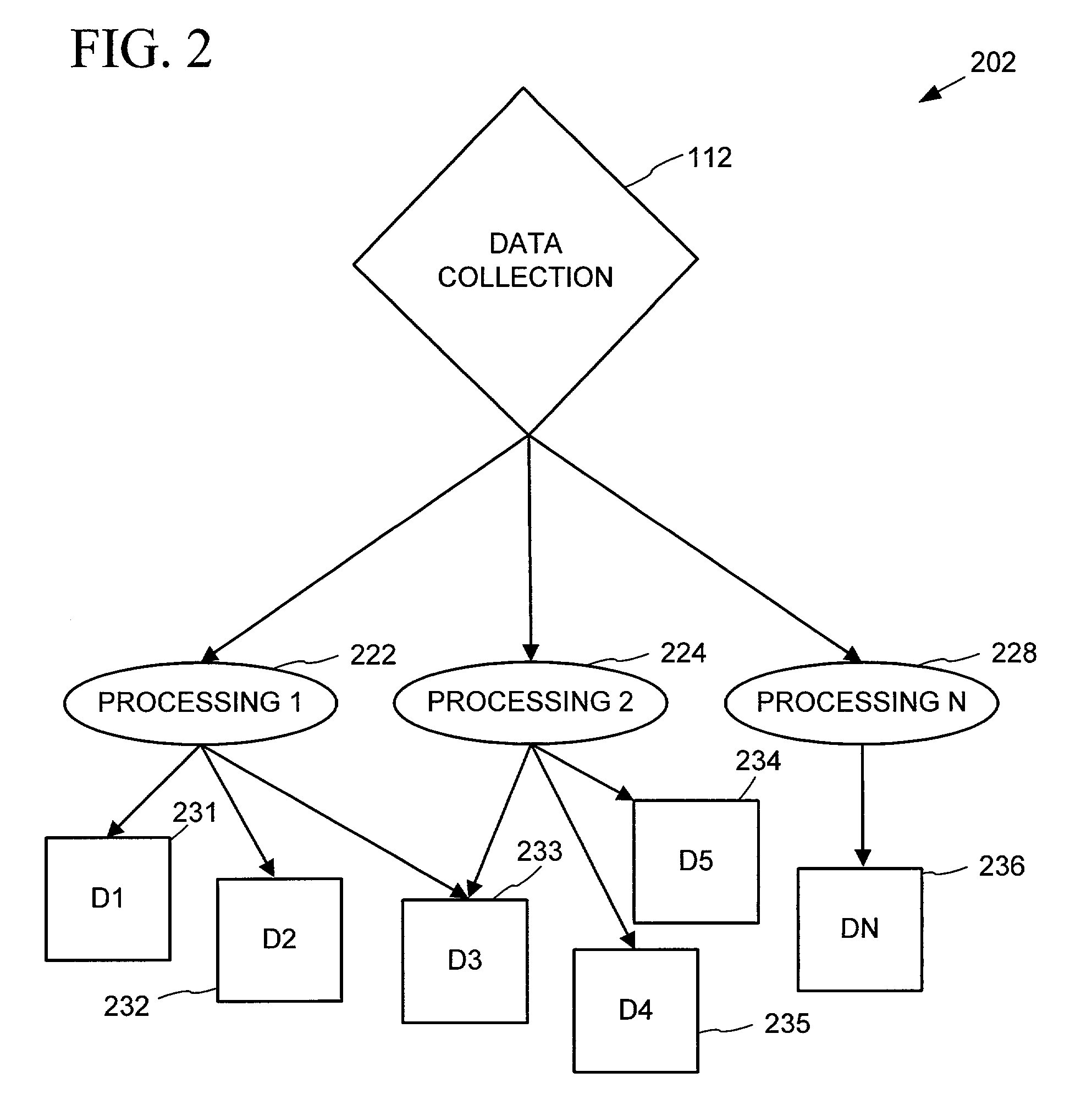

A collection of data is processed and information arising from the processing can be distributed in a variety of ways to support a decision-making process. A query-analyze-distribute approach can be used, and queries, analysis directives, and distribution directives can be associated into a sequence and shared. Access to interim processing is provided, allowing recipients of information to more easily understand and refine the processing. Unbound queries, unbound analysis directives, and unbound distribution directives can be used and shared so that the queries, analysis directives, and distribution directives can be tailored to a particular situation via binding. The query, analysis, and distribution processing can be loosely-coupled to allow easy interchange and combination of sequence elements. A sequence can be scheduled for periodic execution, and distribution of data can be limited to instances when data falls outside of certain expected values. A decision-making process can be automated by creating an executable workflow. The environment in which the workflow is executed can support a rich set of features, including gating, branching, drill down, and execution tracking. A decision-making process based on a sequence can be refined by employing executable metasequences.

Owner:TERADATA US

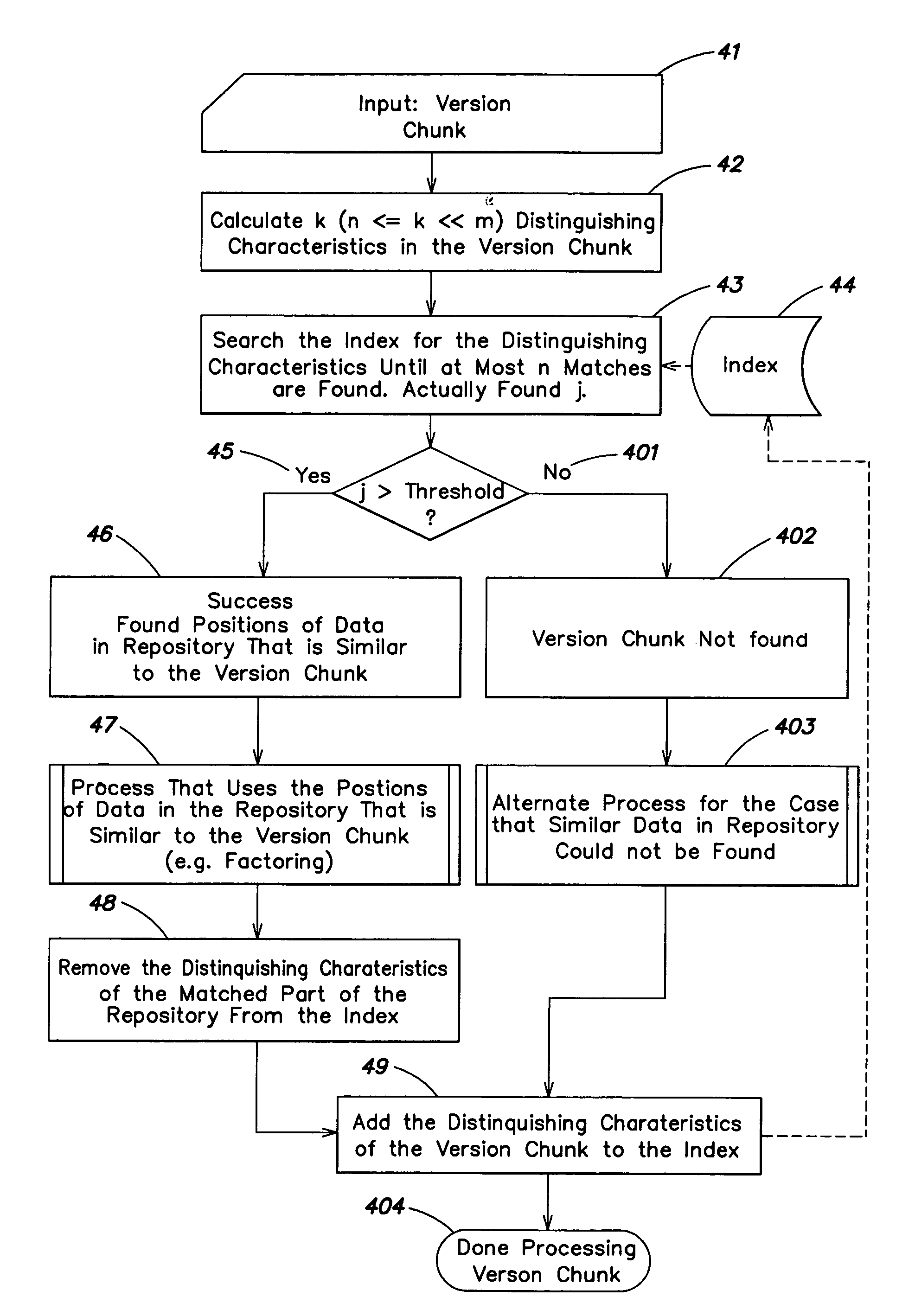

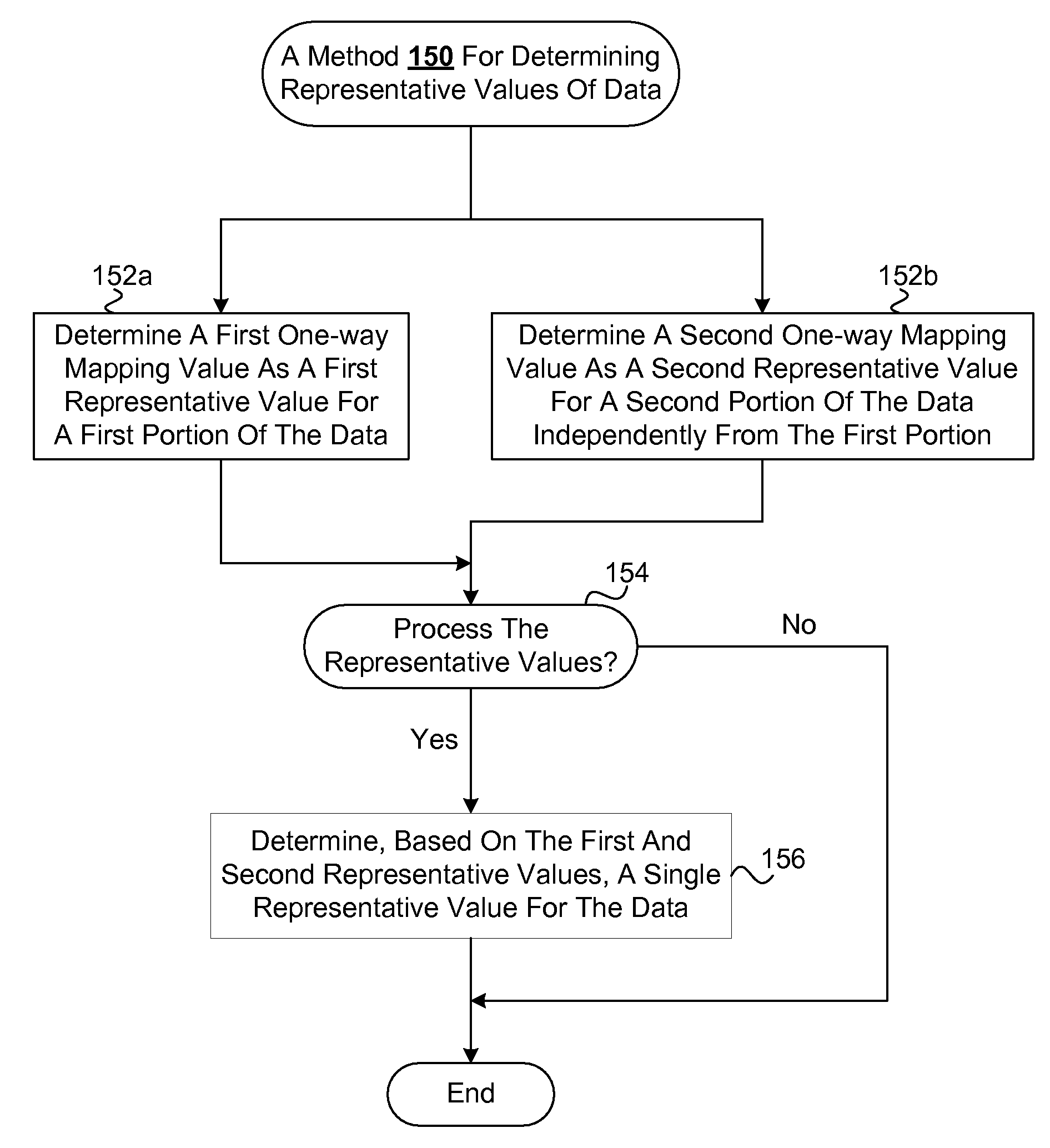

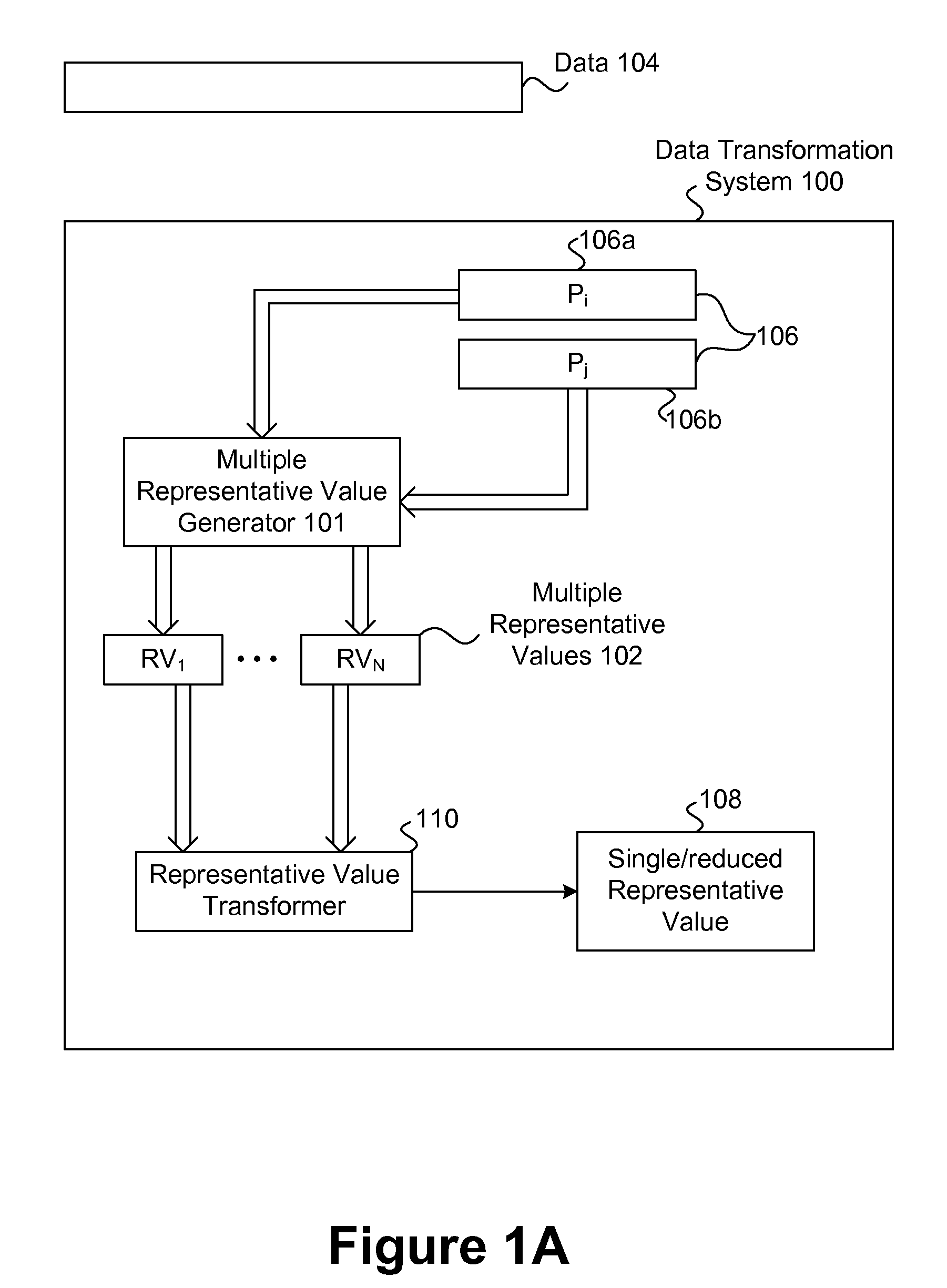

Systems and methods for efficient data searching, storage and reduction

InactiveUS7523098B2Efficiently determinedReduce dataDigital data information retrievalData processing applicationsData segmentTheoretical computer science

Owner:INT BUSINESS MASCH CORP

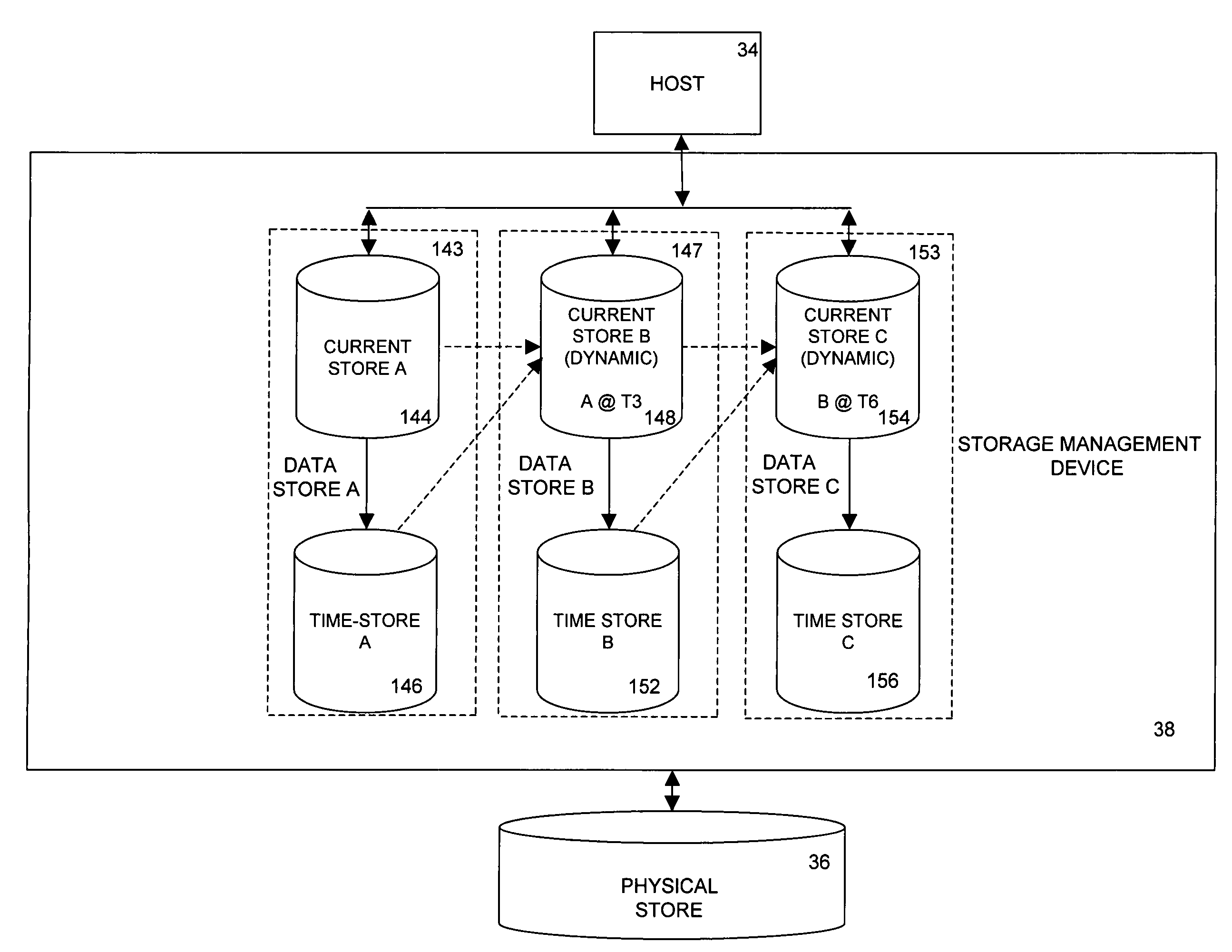

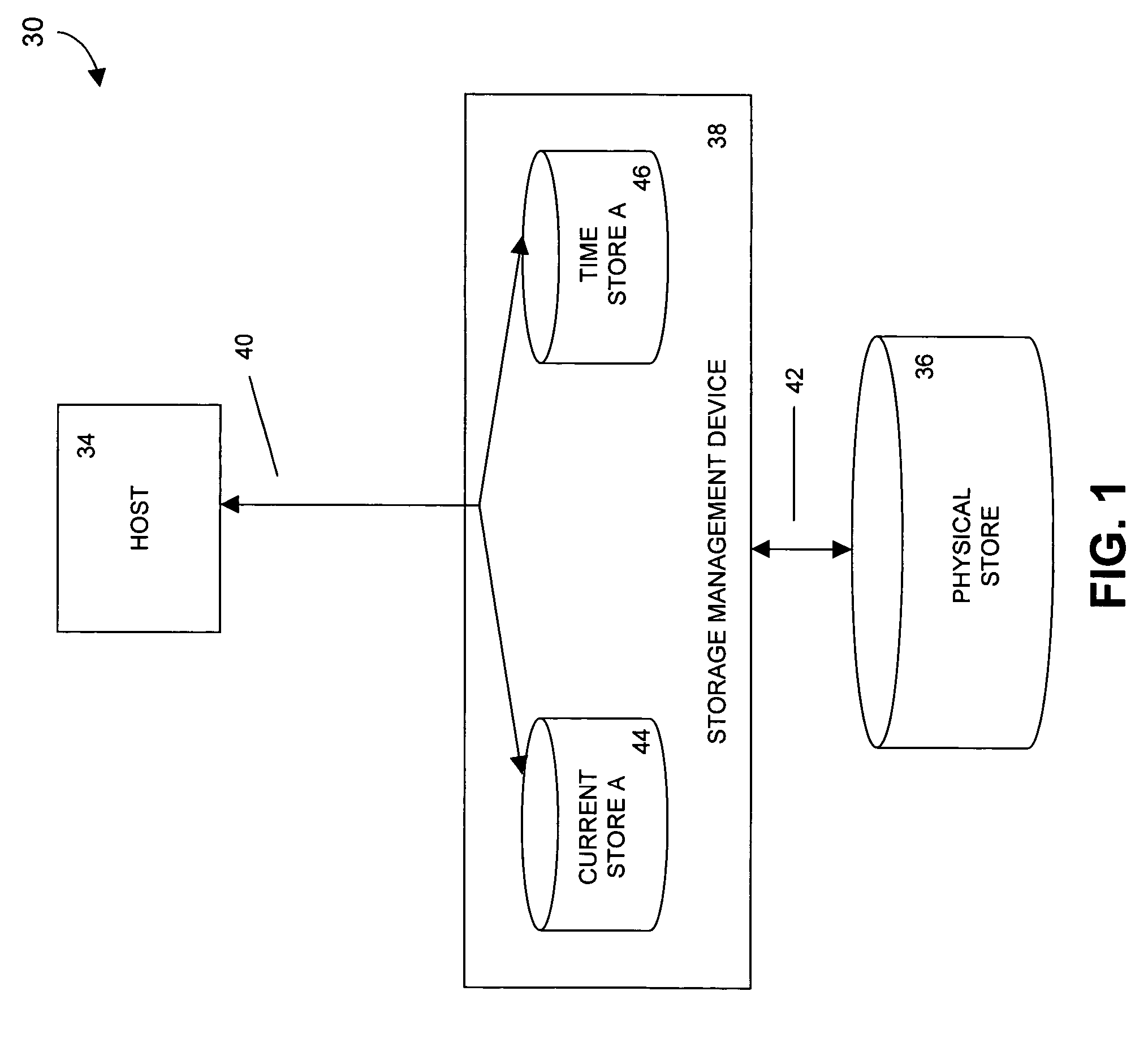

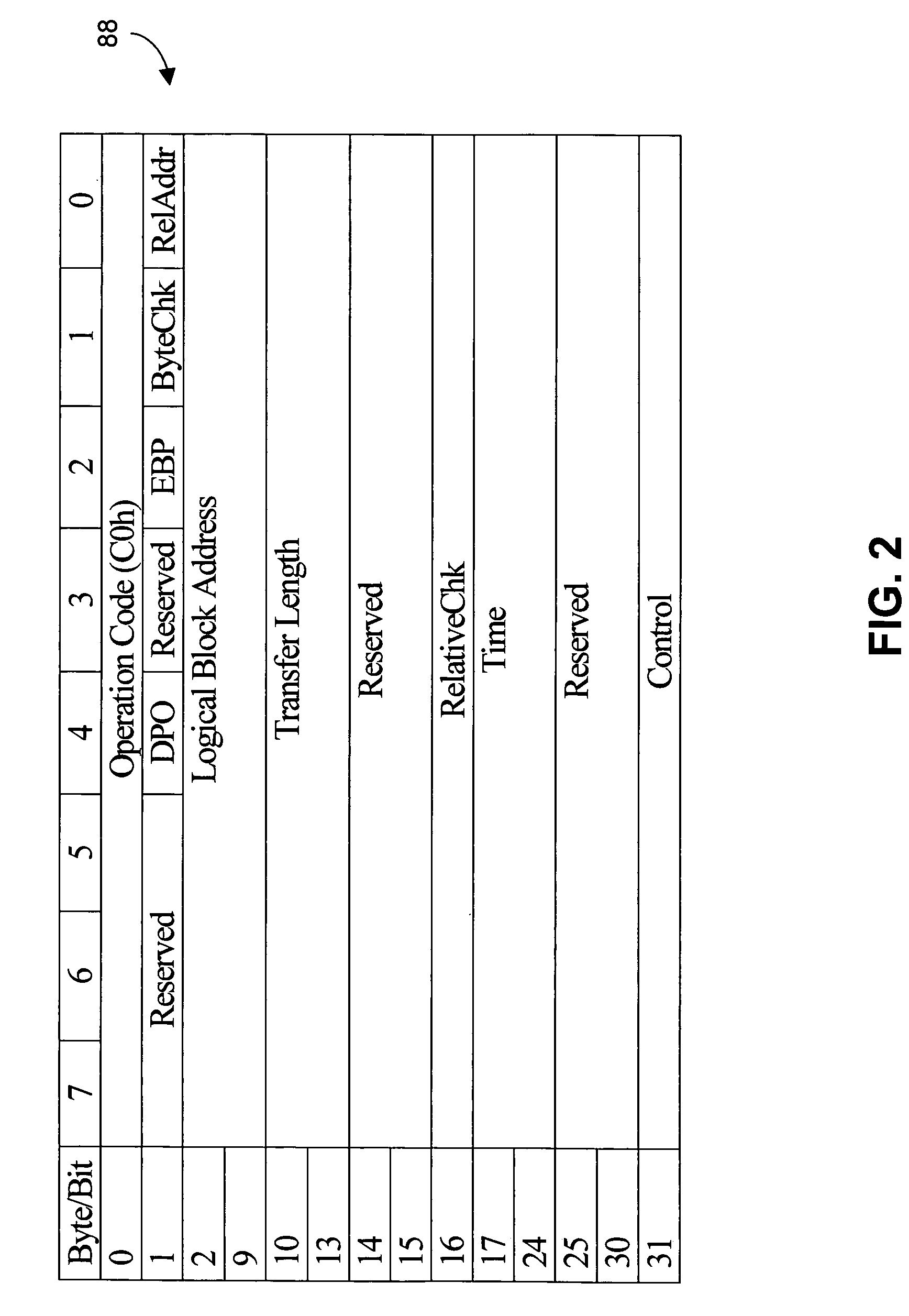

Processing storage-related I/O requests using binary tree data structures

InactiveUS20060047902A1Facilitate determinationEfficiently identifyMemory loss protectionError detection/correctionReceiptBinary tree

The disclosed technology can be used to develop systems and perform methods that receive and process I / O requests directed to at least a part of a logical unit of storage. The I / O requests can be associated with different times corresponding to when such I / O requests were received. Nodes that include non-overlapping address ranges associated with the logical unit of storage can be formed in response to receiving the I / O requests and such nodes can be subsequently organized into a tree data structure. The tree data structure can serve as a basis for determining address overlap, for example to enable processing a first operation associated with a first one of the I / O requests in accordance with the first I / O request's receipt time, while one or more other operations associated with a different I / O request may be processed irrespective of that different I / O request's receipt time. This can be useful in a system in system operations are improved by easy access to information about whether pending I / O requests are directed to overlapping units of storage.

Owner:SYMANTEC OPERATING CORP

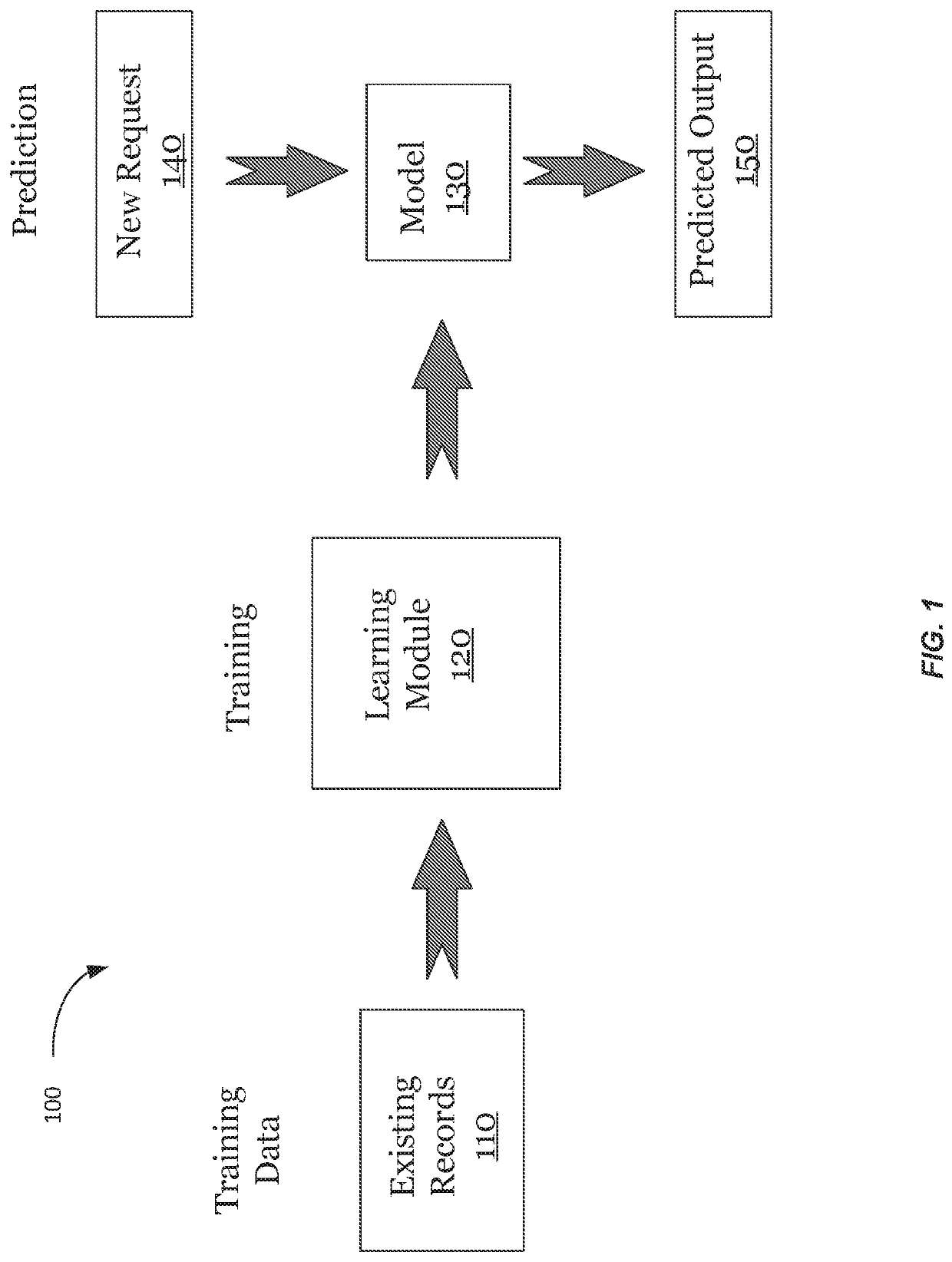

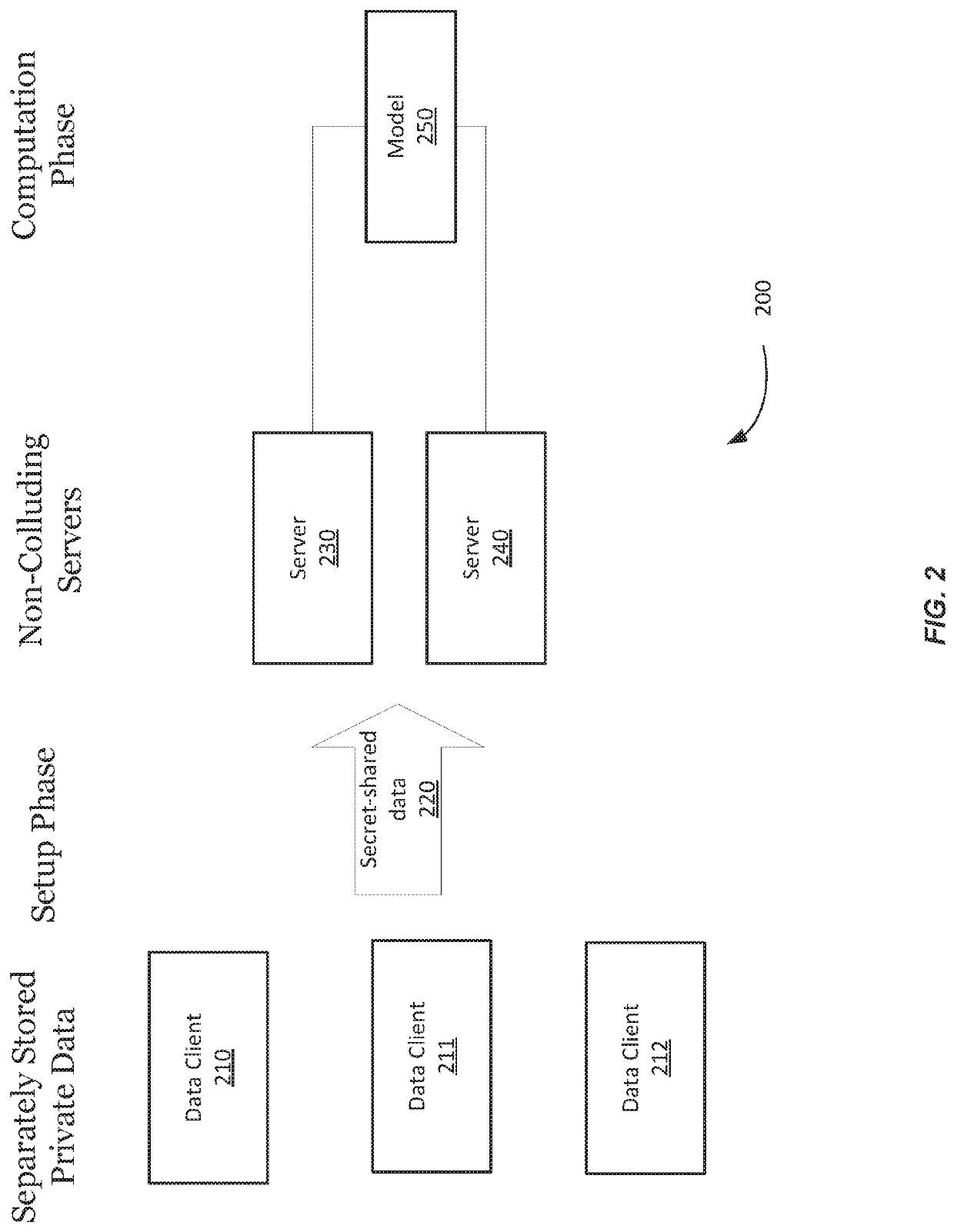

Privacy-preserving machine learning

ActiveUS20200242466A1Efficiently determinedLimited amount of memoryKey distribution for secure communicationDigital data protectionStochastic gradient descentAlgorithm

New and efficient protocols are provided for privacy-preserving machine learning training (e.g., for linear regression, logistic regression and neural network using the stochastic gradient descent method). A protocols can use the two-server model, where data owners distribute their private data among two non-colluding servers, which train various models on the joint data using secure two-party computation (2PC). New techniques support secure arithmetic operations on shared decimal numbers, and propose MPC-friendly alternatives to non-linear functions, such as sigmoid and softmax.

Owner:VISA INT SERVICE ASSOC

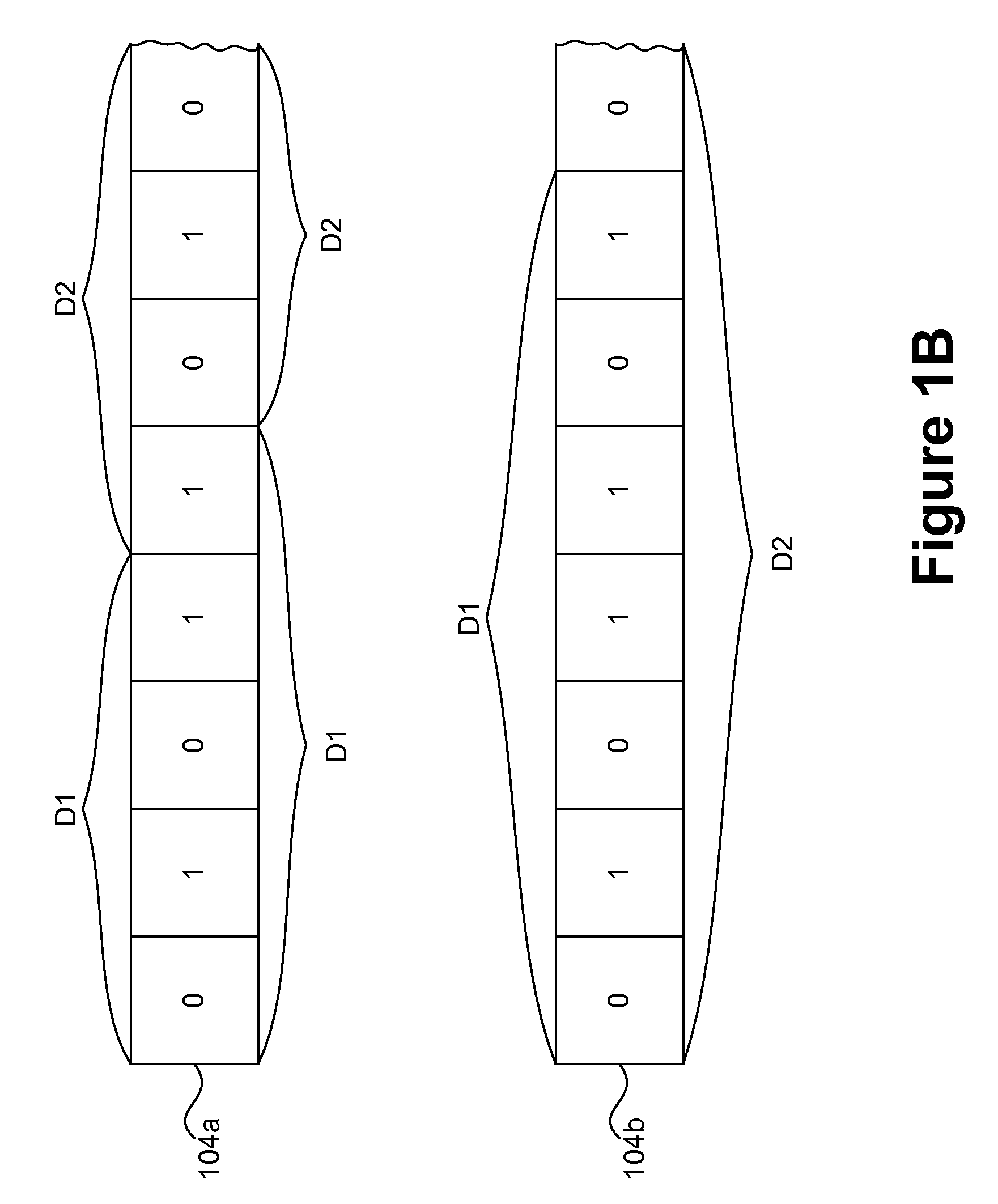

Representation and verification of data for safe computing environments and systems

InactiveUS20100106976A1Efficient verificationLess timeDigital data information retrievalUnauthorized memory use protectionDatasheetData integrity

Techniques for representation and verification of data are disclosed. The techniques are especially useful for representation and verification of the integrity of data (integrity verification) in safe computing environments and / or systems (e.g., Trusted Computing (TC) systems and / or environments). Multiple independent representative values can be determined independently and possibly in parallel for respective portions of the data. The independent representative values can, for example, be hash values determined at the same time for respective distinct portions of the data. The integrity of the data can be determined based on the multiple hash values by, for example, processing them to determine a single hash value that can serve as an integrity value. By effectively dividing the data into multiple portions in multiple processing streams and processing them in parallel to determine multiple hash values simultaneously, the time required for hashing the data can be reduced in comparison to conventional techniques that operate to determine a hash value for the data as a whole and in a single processing stream. As a result, the time required for integrity verification can be reduced, thereby allowing safe features to be extended to devices that may operate with relatively limited resources (e.g., mobile and / or embedded devices) as well as improving the general efficiency of device that are or will be using safety features (e.g., Trusted Computing (TC) device).

Owner:SAMSUNG ELECTRONICS CO LTD

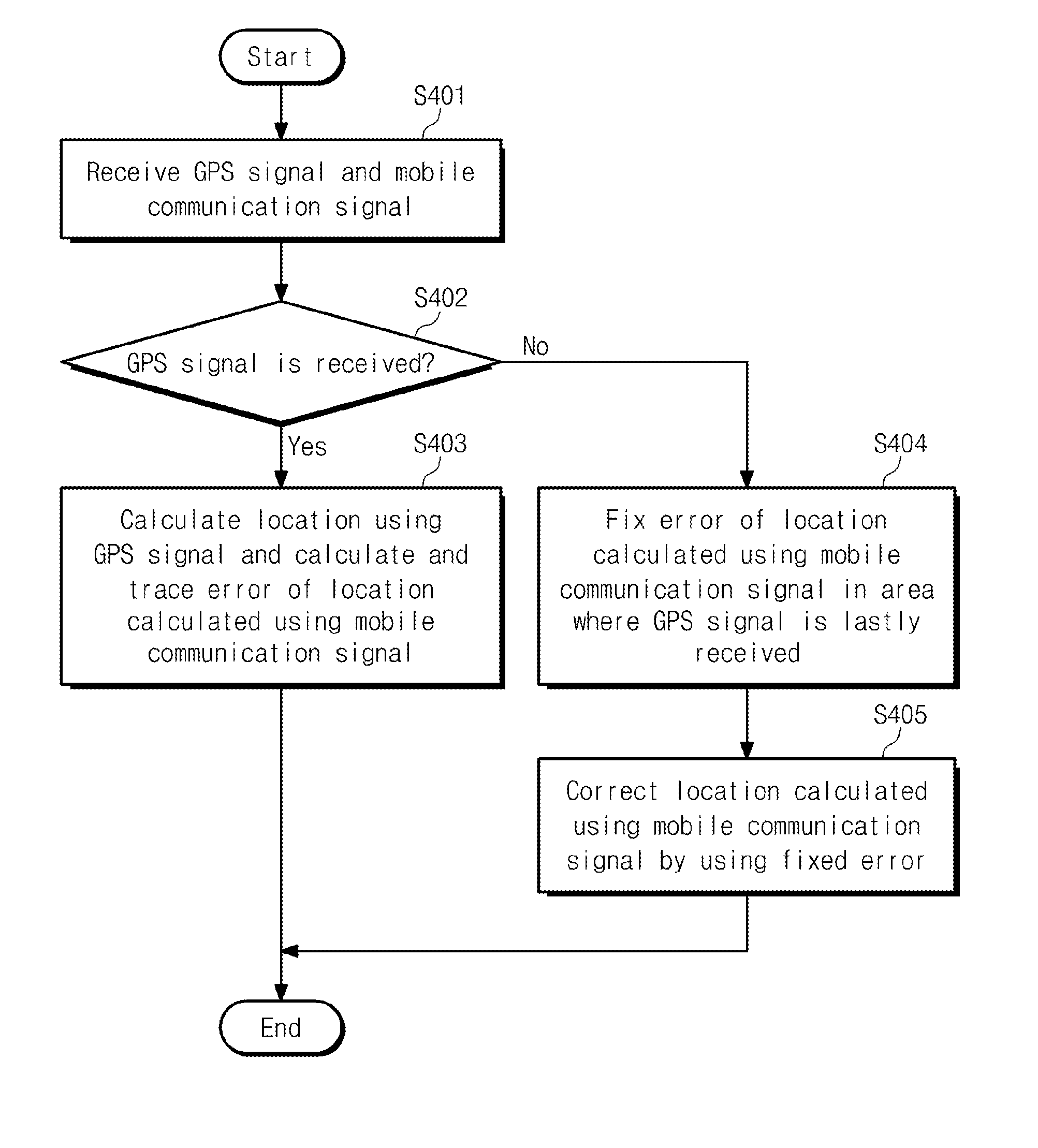

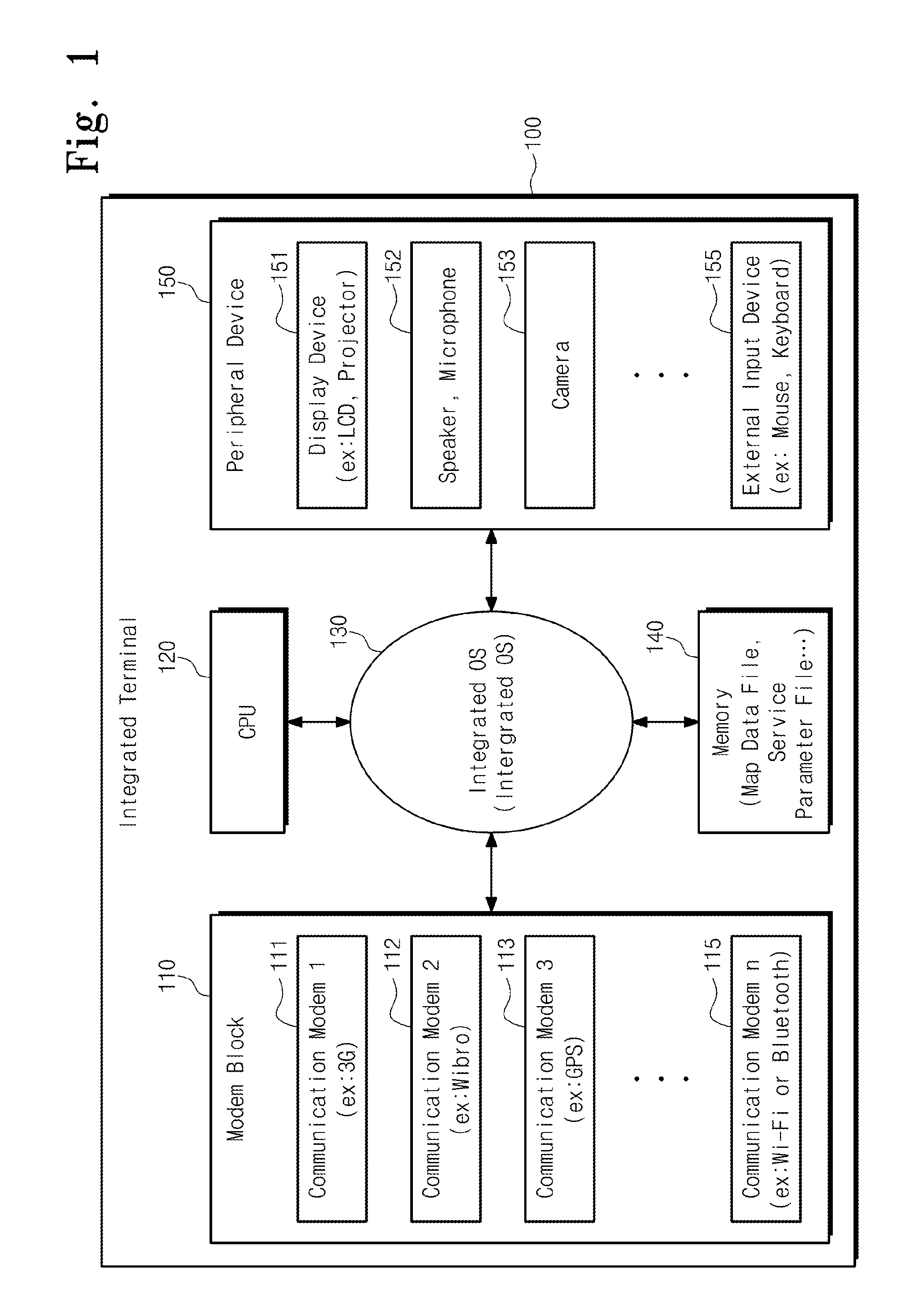

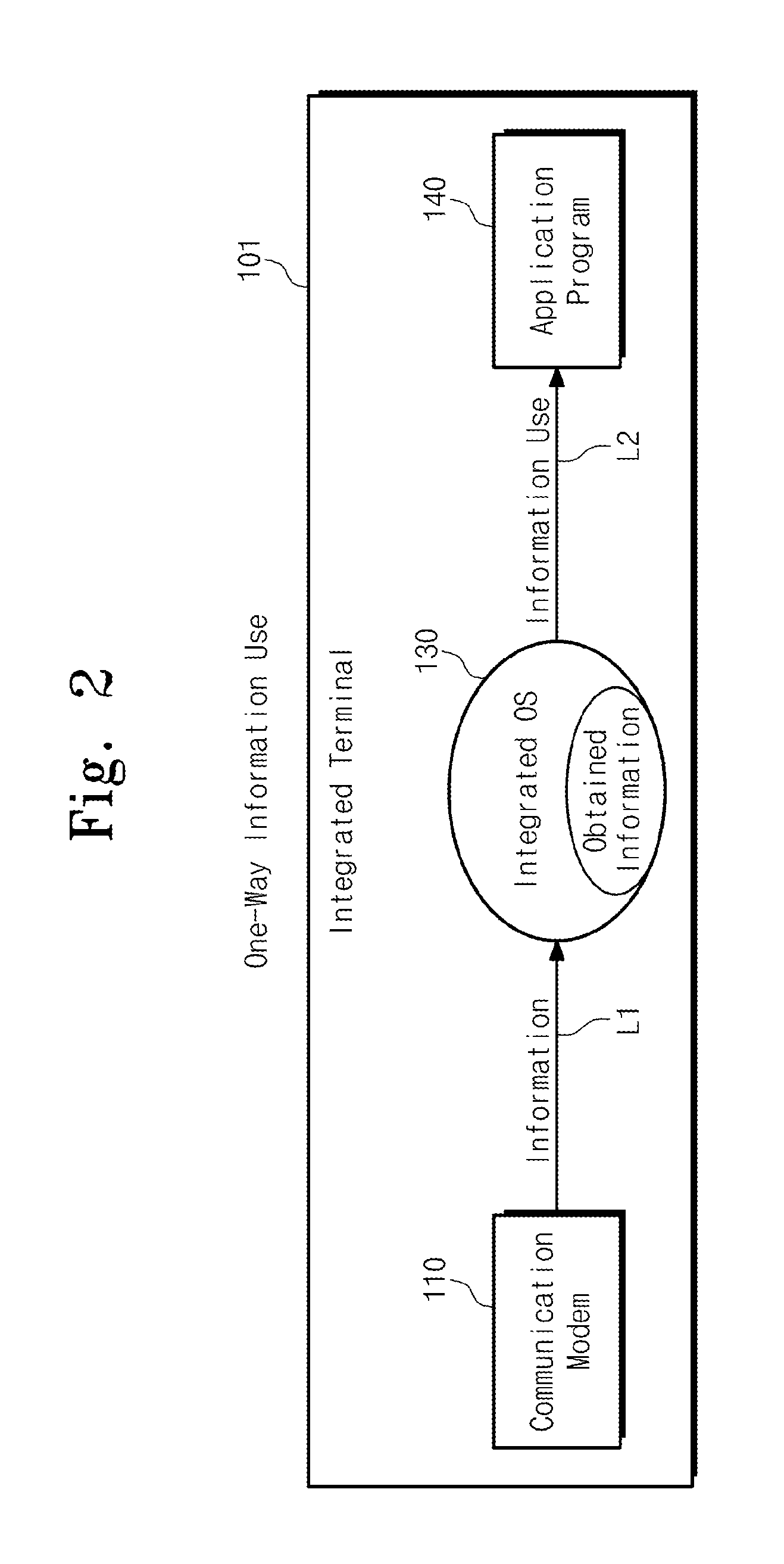

Location information decision method in integrated terminal

InactiveUS20120062415A1Correctly determining location informationEfficiently determinedPosition fixationSatellite radio beaconingEmbedded systemReliability engineering

Provided is a method of efficiently determining a location of a terminal. The method includes receiving both of a GPS signal and a mobile communication signal. When the GPS signal is not received, a location calculated using the mobile communication signal is determined as the location of the terminal.

Owner:ELECTRONICS & TELECOMM RES INST

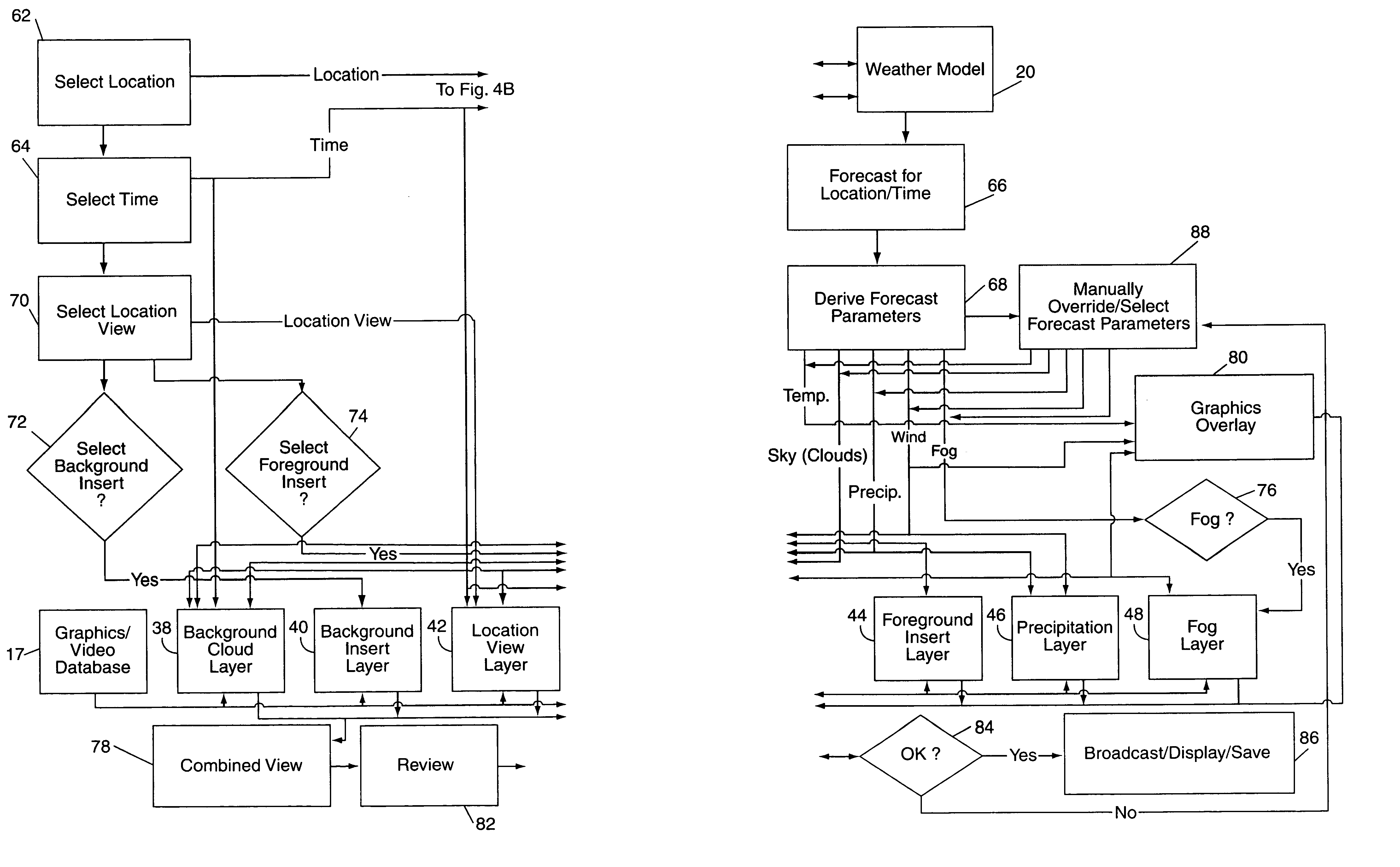

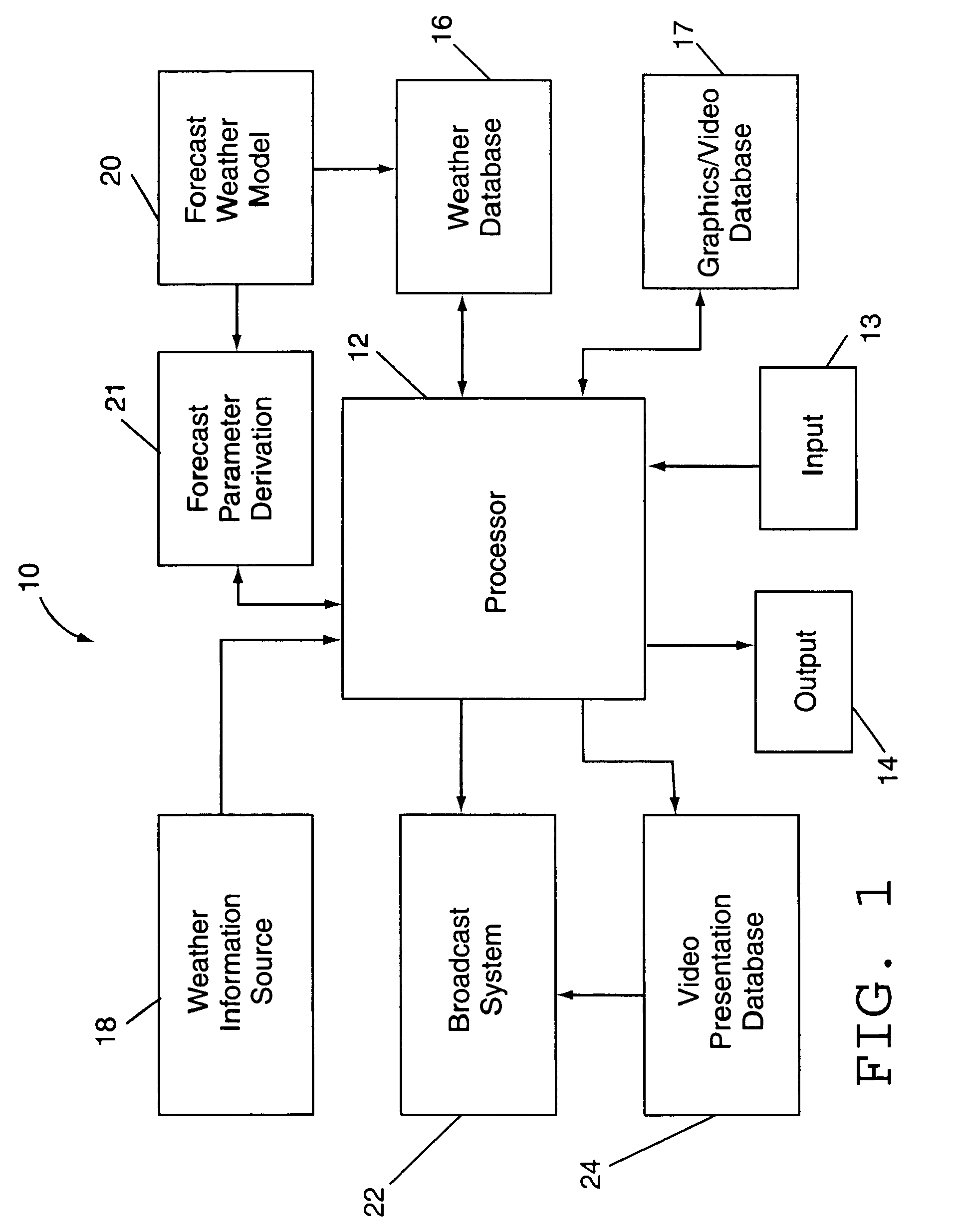

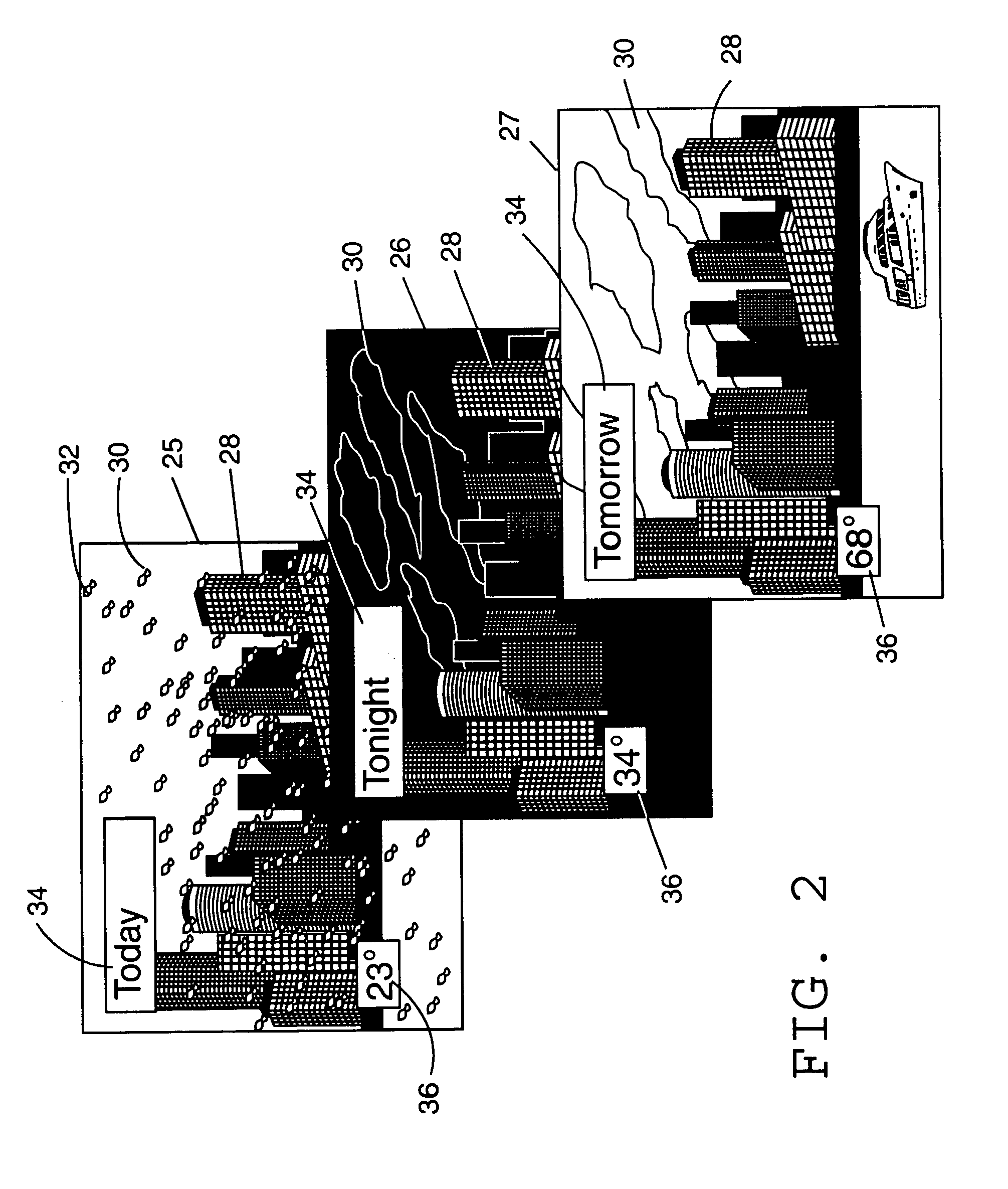

Forecast weather video presentation system and method

InactiveUS6961061B1Easily and rapidlyEasy to findTelevision system detailsColor television detailsGraphicsTime segment

A system and method for generating a realistic weather forecast visualization. Realistic weather graphics and animations are combined with a view of a location of interest to allow weather presentation viewers to visualize future forecast weather conditions as they would actually be seen. A forecast weather video presentation may be formed by selecting and combining pre-rendered or pre-recorded video segments based on user selected time period and location parameters and model generated forecast weather data.

Owner:DTN LLC

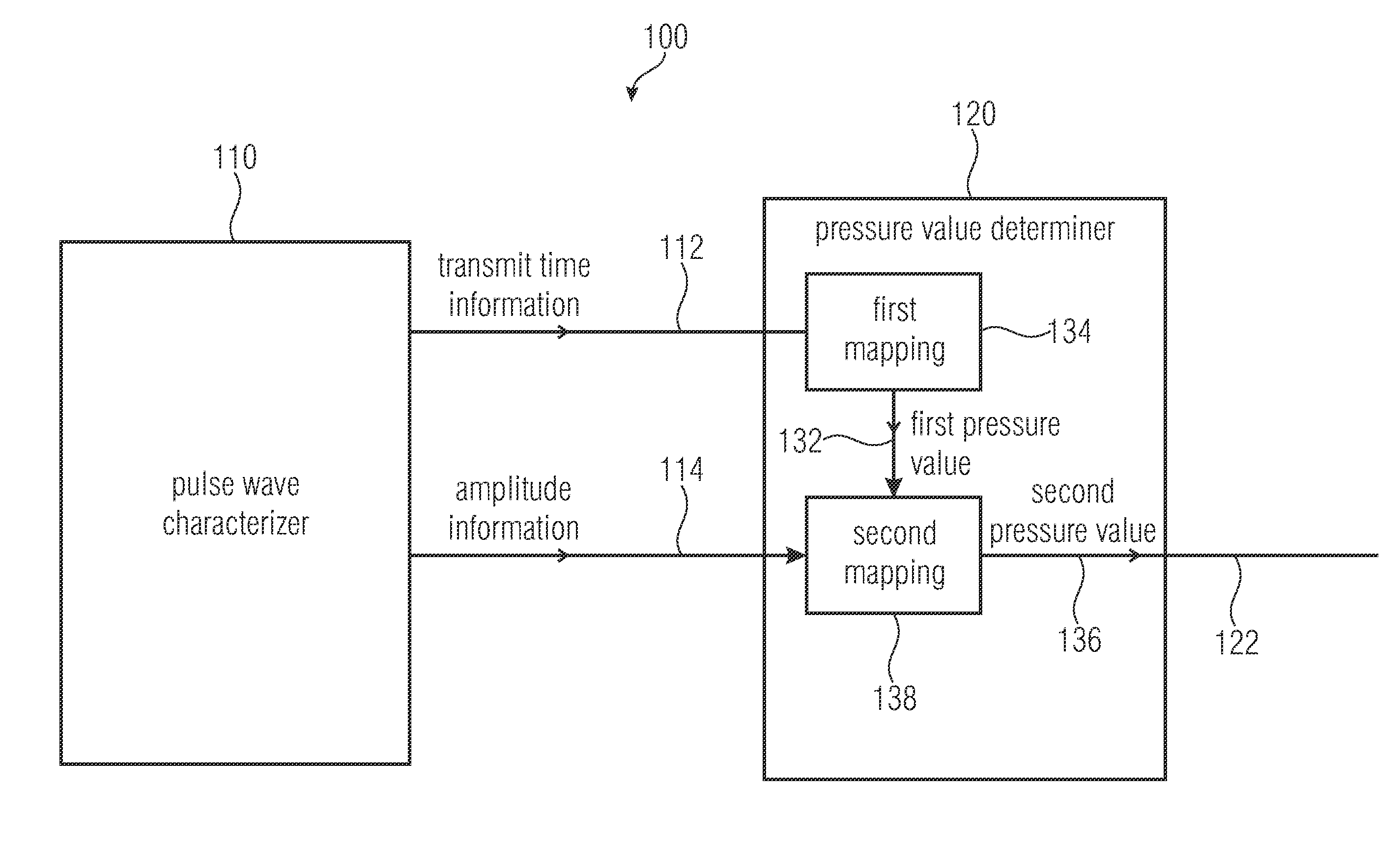

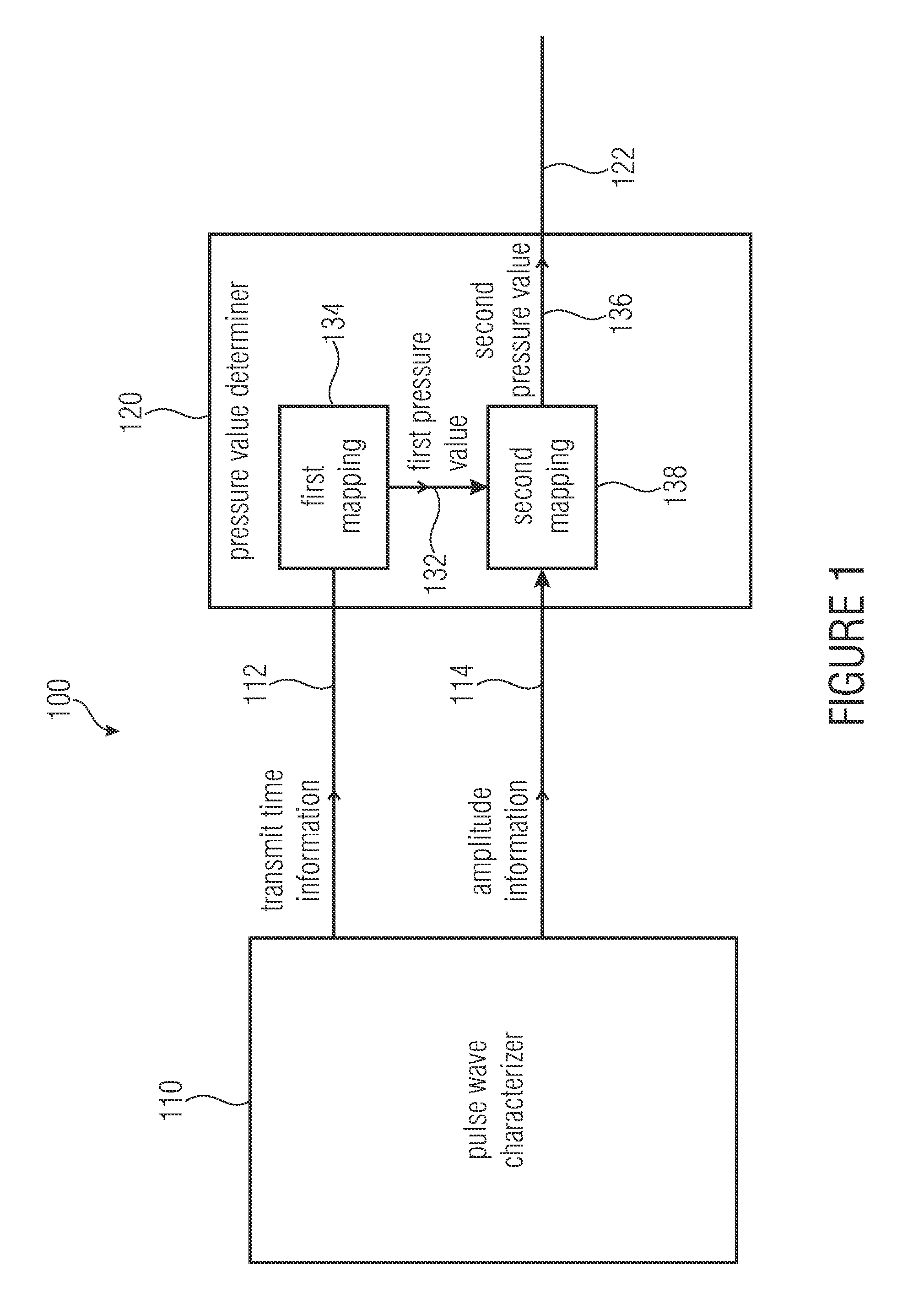

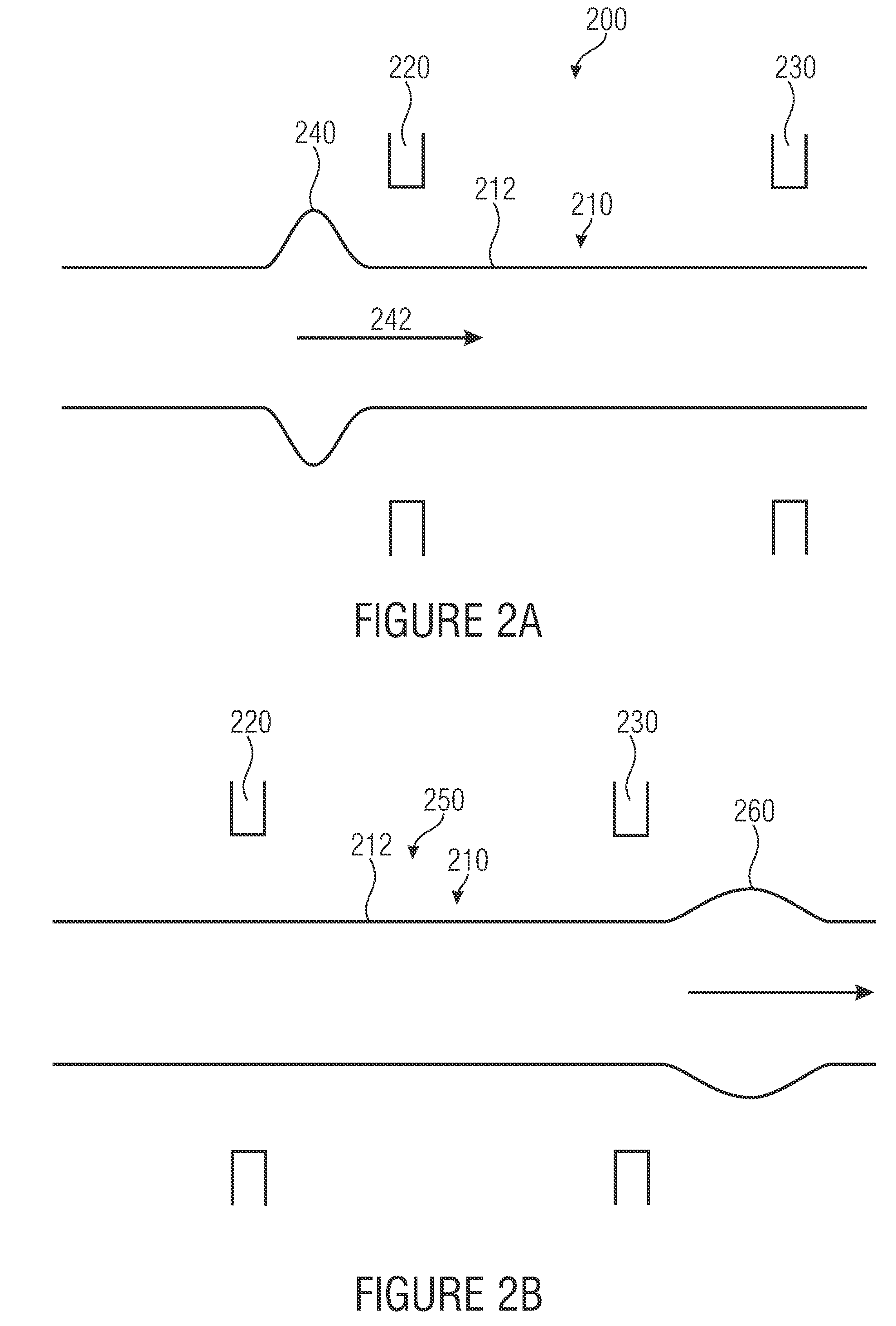

Pressure gauge, blood pressure gauge, method of determining pressure values, method of calibrating a pressure gauge, and computer program

InactiveUS20120065525A1Efficiently determinedTesting/calibration apparatusEvaluation of blood vesselsTime informationBlood pressure

A pressure gauge for determining at least one pressure value describing a pressure of a fluid flowing in a pulsating manner in a phase of the pulsating flow, includes a pulse wave characterizer. The pulse wave characterizer is configured to obtain transmit time information of a pulse wave, and amplitude information of the pulse wave. The pressure gauge additionally includes a pressure value determiner configured to obtain a first pressure value describing a pressure of the fluid in a first phase, on the basis of the transmit time information and while using a mapping. The pressure value determiner is further configured to obtain a second pressure value describing a pressure of the fluid in a second phase, on the basis of the first pressure value and the amplitude information while using a mapping.

Owner:FRAUNHOFER GESELLSCHAFT ZUR FOERDERUNG DER ANGEWANDTEN FORSCHUNG EV

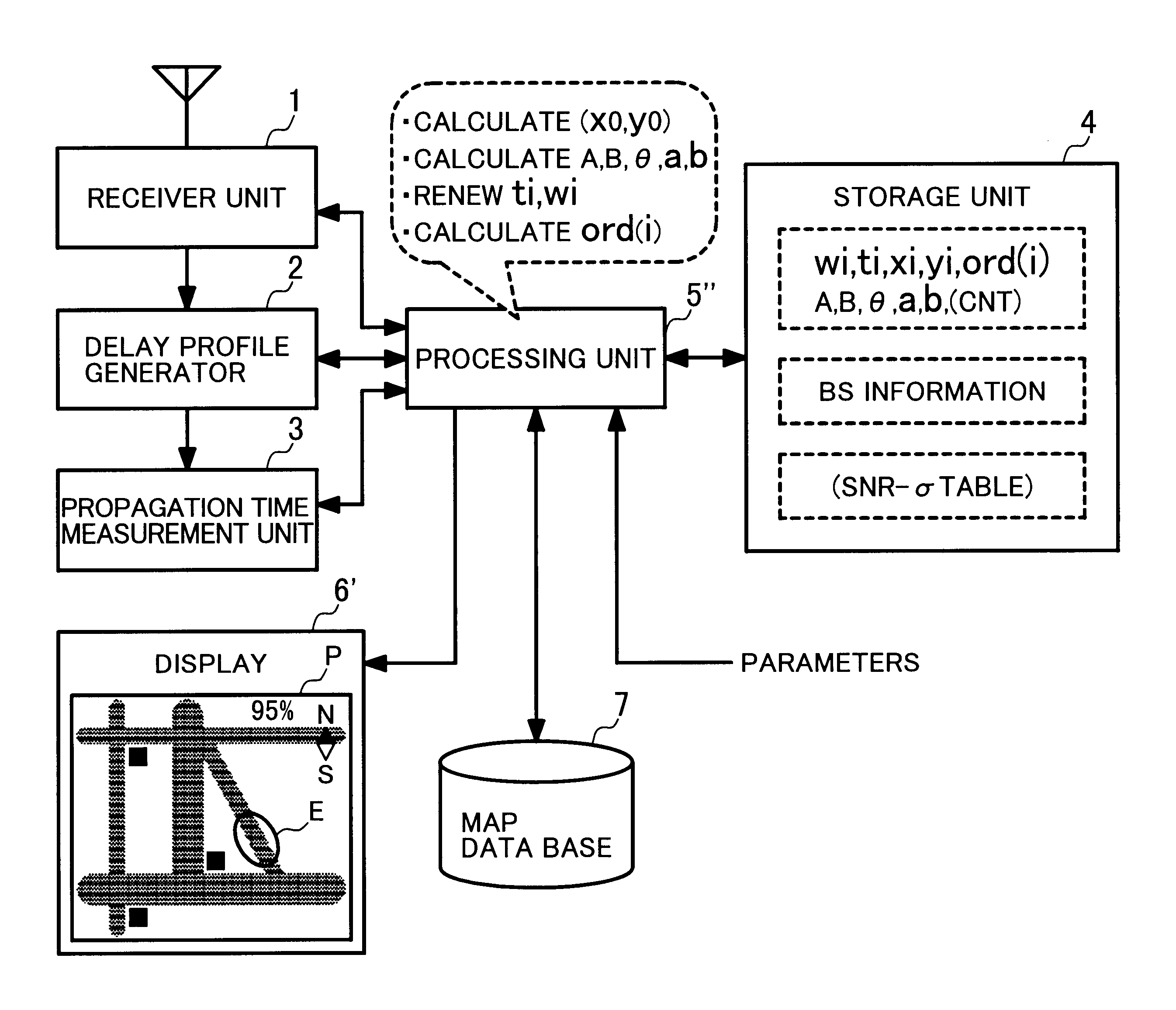

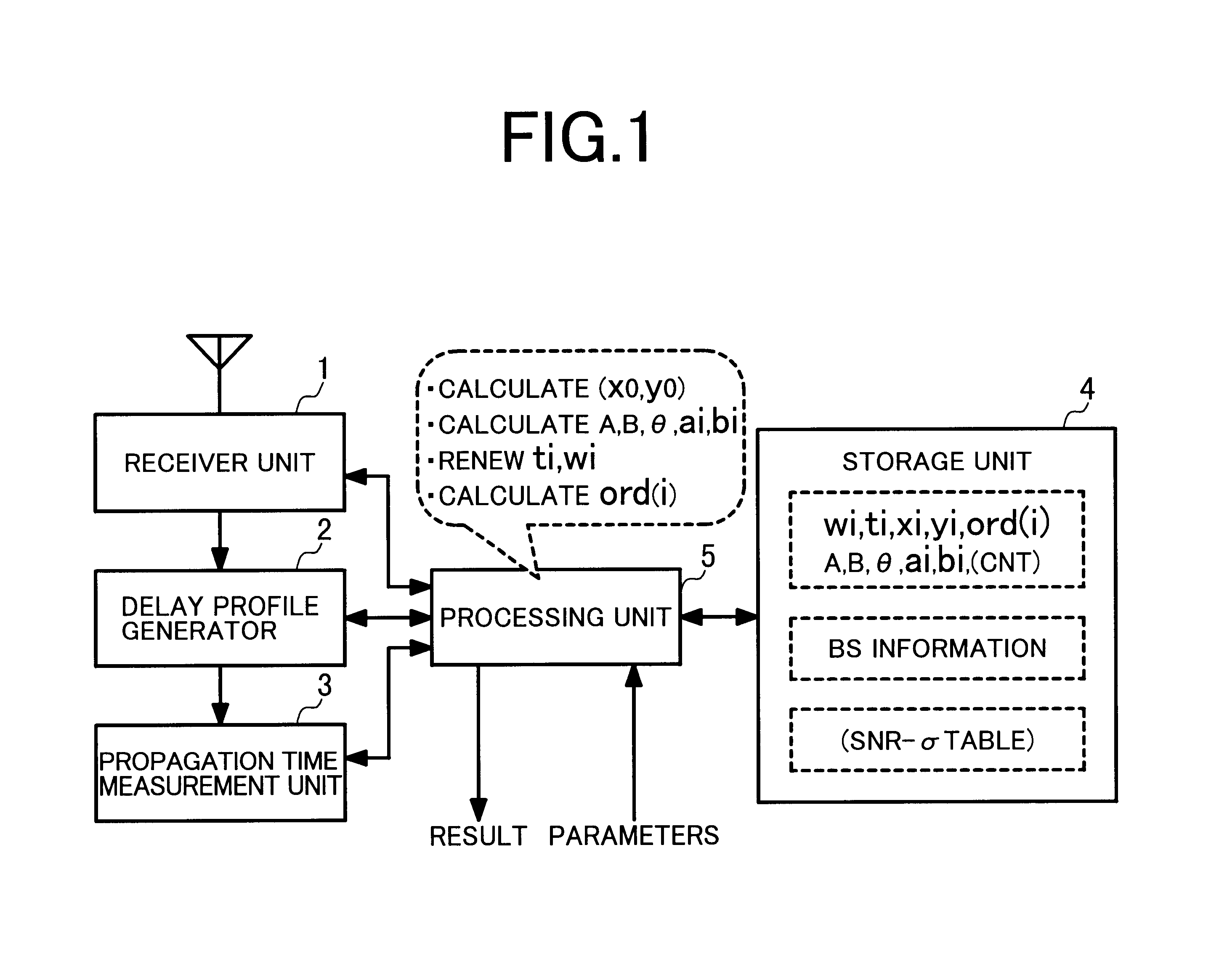

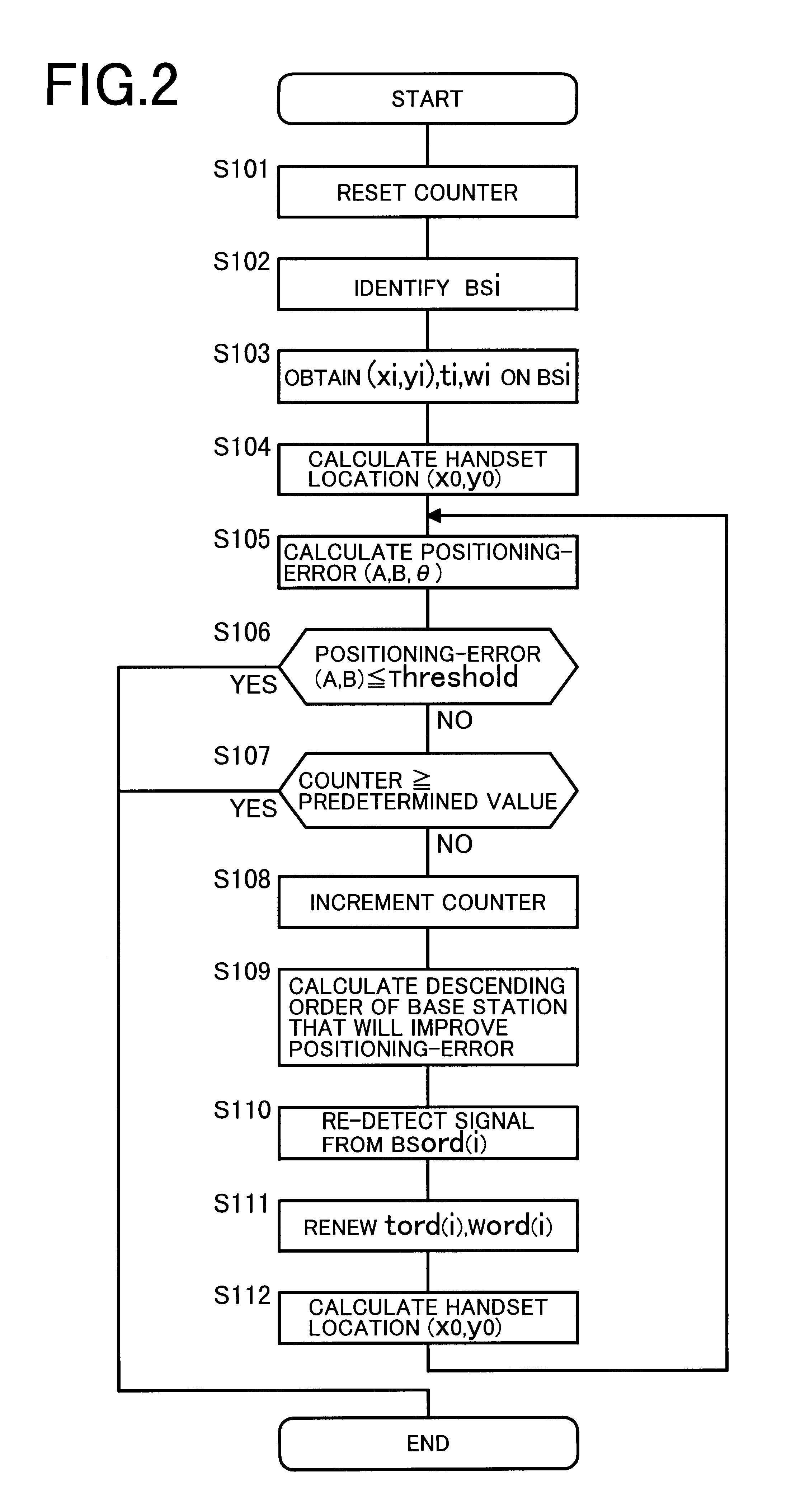

Location detection method, location detection system and location detection program

InactiveUS6865394B2Increase in powerIncrease in timeBeacon systems using radio wavesRoad vehicles traffic controlLocation detectionPropagation delay

A positioning method, which is related to a technique to measure a correct position of a terminal by preventing time required for the position measurement, of calculating a position of a receiver according to signals from a plurality of wireless transmitters includes a first step of measuring propagation delay time of the signal from each of the wireless transmitters and calculating a position of the receiver and a standard deviation about measuring distance error, a second step of calculating a positioning error of the receiver a third step of determining, according to the positioning error calculated by the second step, wireless transmitters in directions nearer to a direction in which the positioning error is large, and a fourth step of re-detecting signals from the wireless transmitters determined by the third step and thereby re-calculating the position of the receiver.

Owner:HITACHI LTD

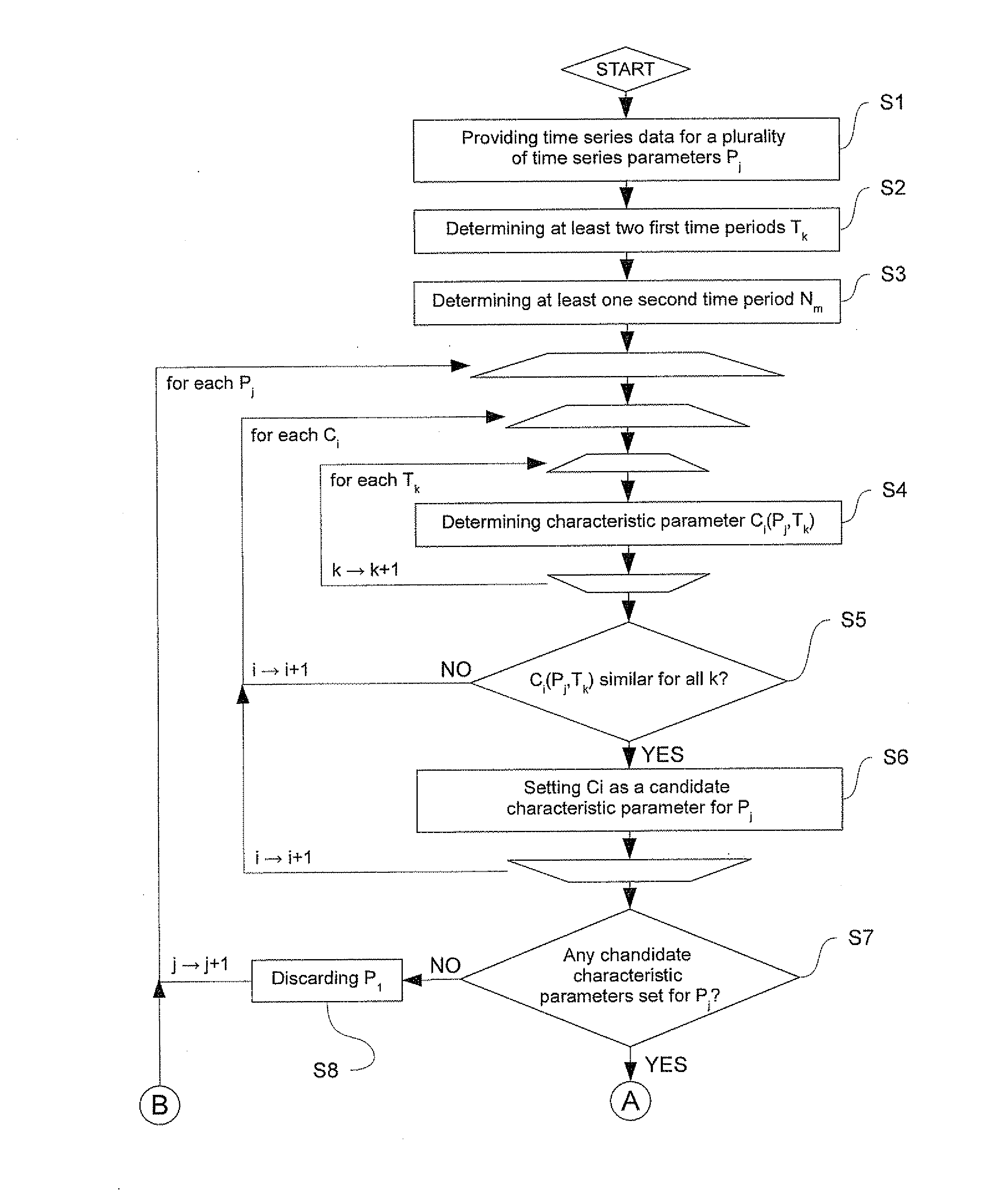

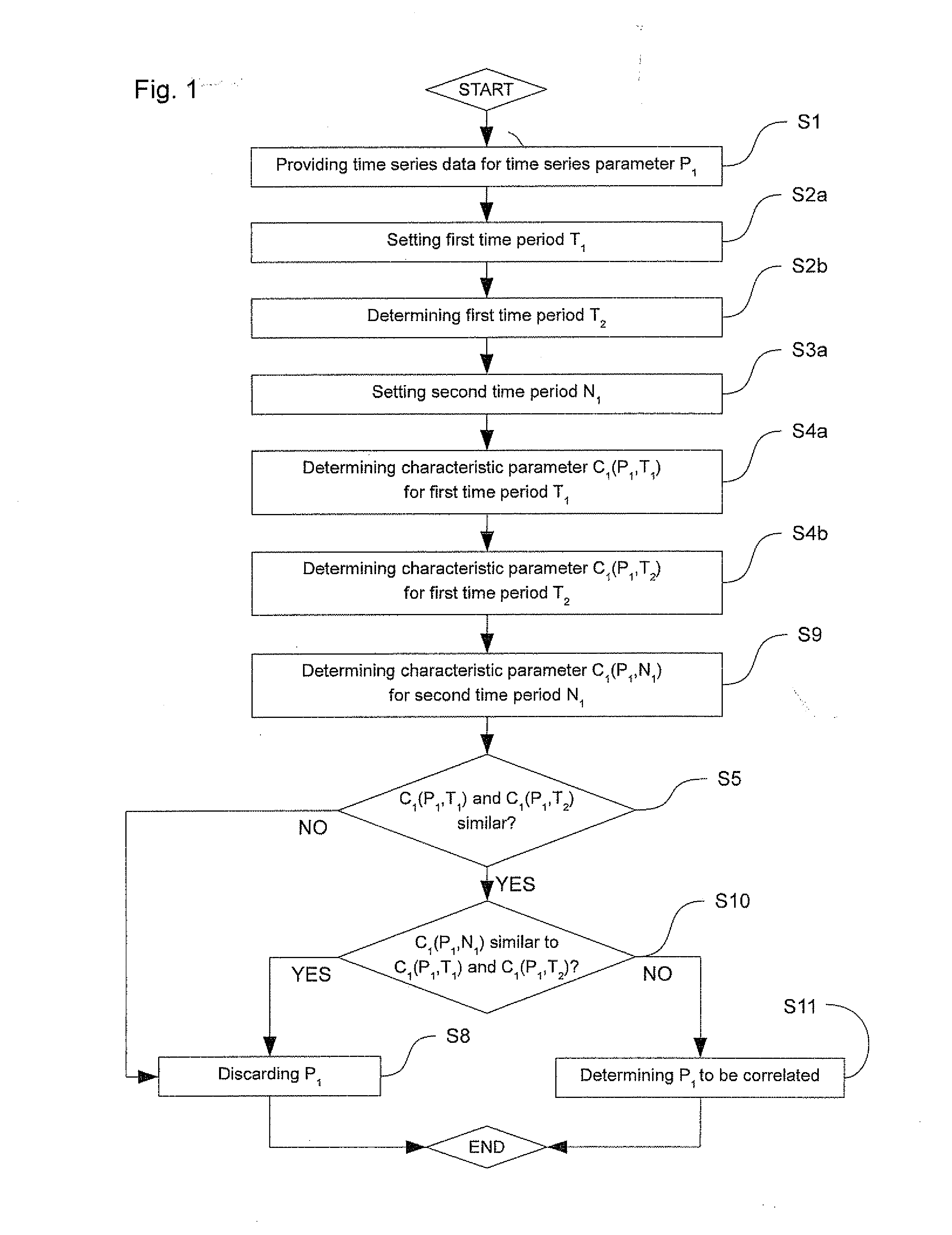

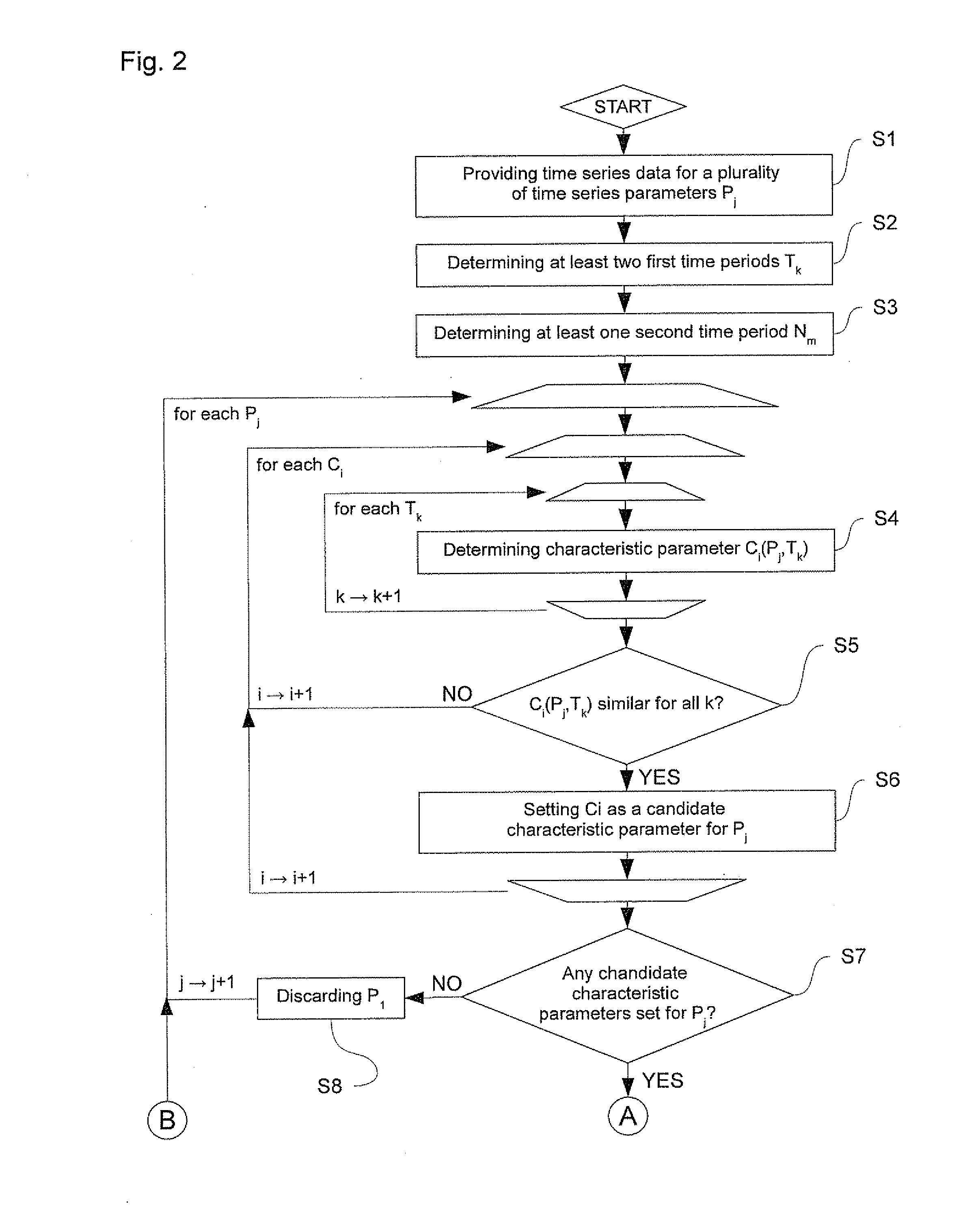

Method and apparatus for analyzing time series data

ActiveUS20110035188A1Improve accuracyReliable methodTime indicationSynchronous motors for clocksState dependentTime segment

The present invention relates to a method and an apparatus for determining which one or more time series parameters of a plurality of time series parameters relating to operation of a system are correlated with a first operation state of the system. According to the invention, the method comprises providing time series data including data relating to a time series of each of the plurality of time series parameters; determining at least two first time periods, wherein the system is in the first operation state during the at least two first time periods; determining at least one second time period, wherein the system is in a second operation state during the at least one second time period; determining, for each respective time series parameter of the plurality of time series parameters, a first characteristic parameter relating to a first characteristic of the time series of the respective time series parameter for each of the at least two first time periods and the at least one second time period; and determining which one or more time series parameters of the plurality of time series parameters relating to the operation of the system are correlated with the first operation state of the system by determining, for each respective time series parameter of the plurality of time series parameters, whether or not the respective time series parameter is correlated with the first operation state of the system based on the first characteristic parameters of the respective time series parameter determined for each of the at least two first time periods and the at least one second time period.

Owner:EUROPEAN SPACE AGENCY

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com