Patents

Literature

57 results about "Price differential" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Definition of Price Differential. Price Differential means, with respect to any Purchased Asset as of any date, the aggregate amount obtained by daily application of the applicable Pricing Rate for such Purchased Asset to the Purchase Price of such Purchased Asset on a 360-day-per-year basis for the actual number of days during each Pricing Rate...

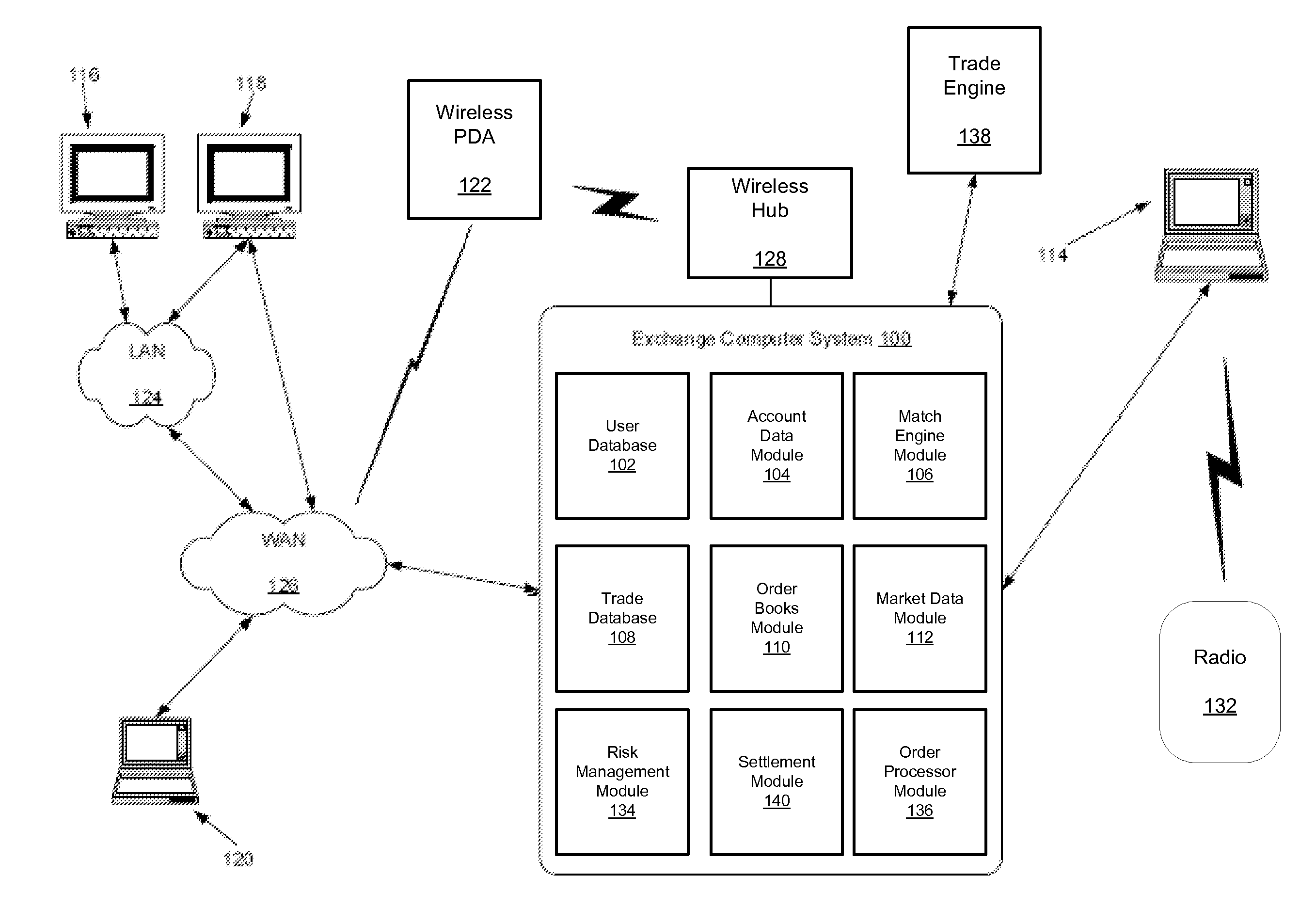

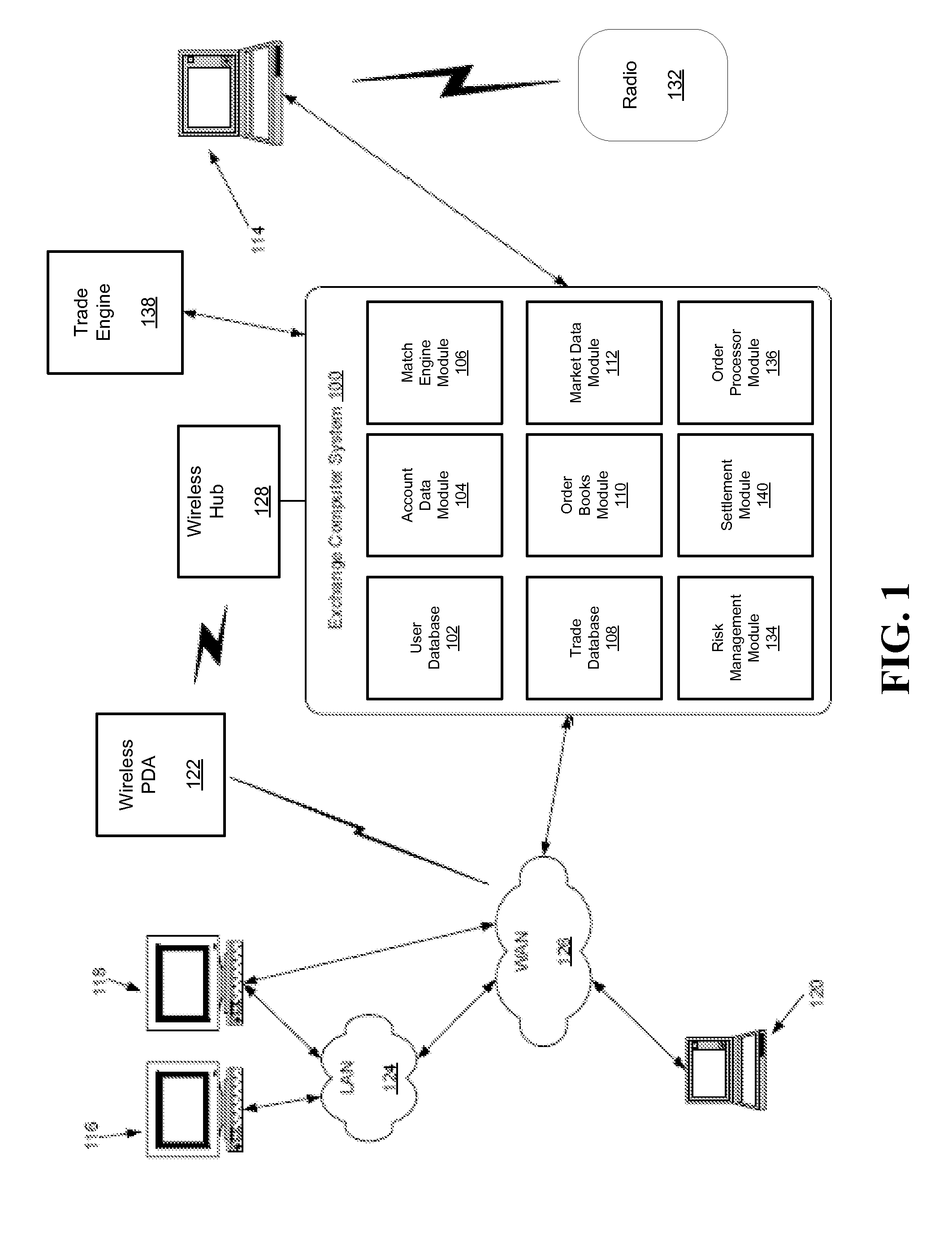

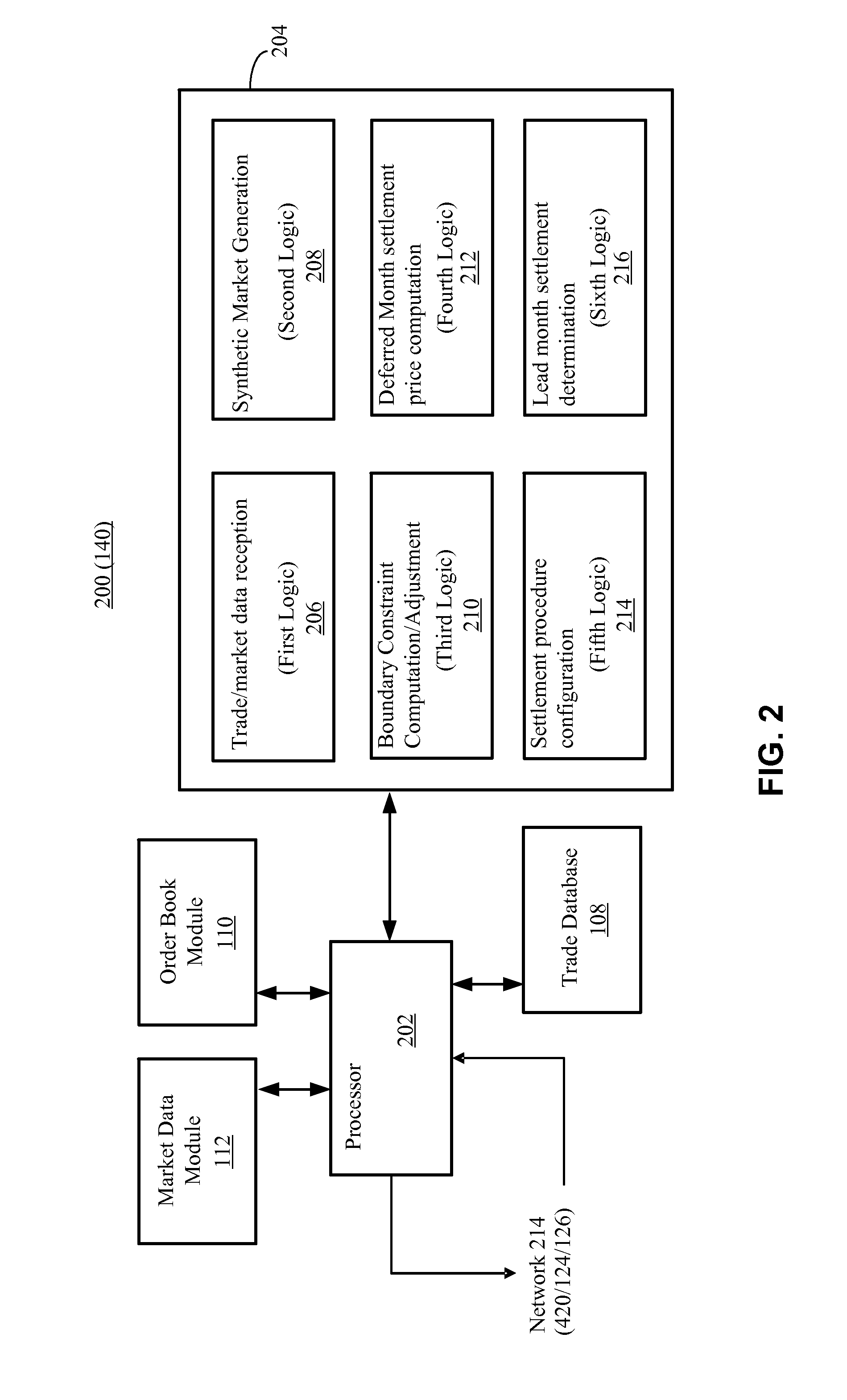

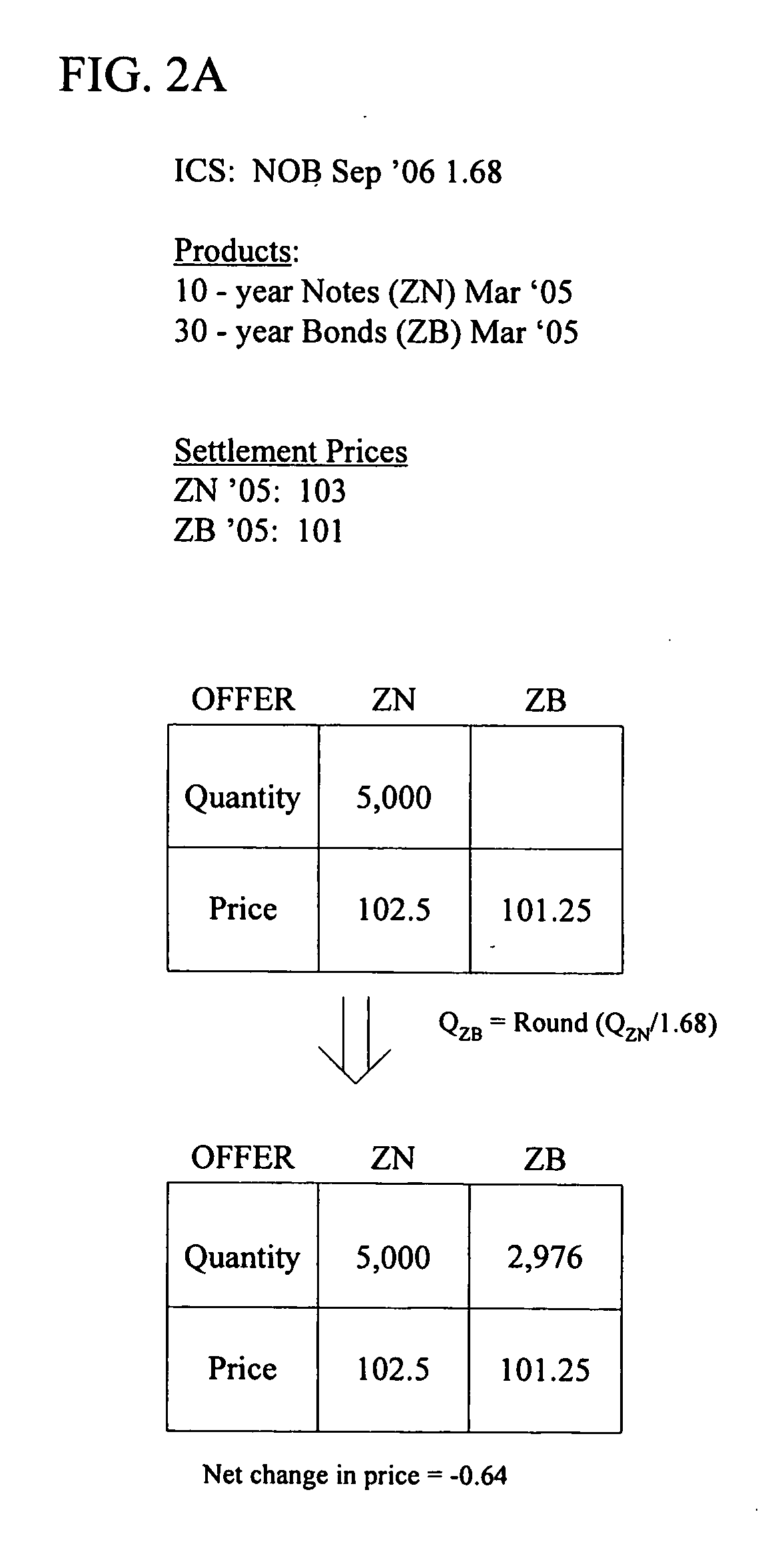

Boundary Constraint-Based Settlement in Spread Markets

A computer implemented method determines a settlement price for a constituent contract of a plurality of spread instruments. The method includes obtaining market data indicative of bid-offer values for the plurality of spread instruments, generating synthetic market data for the constituent contract based on the bid-offer values and based on a respective settlement price for an active contract of each spread instrument of the plurality of spread instruments, determining boundary constraints on the settlement price for the constituent contract based on the synthetic market data, and computing the settlement price for the constituent contract based on the boundary constraints.

Owner:CHICAGO MERCANTILE EXCHANGE

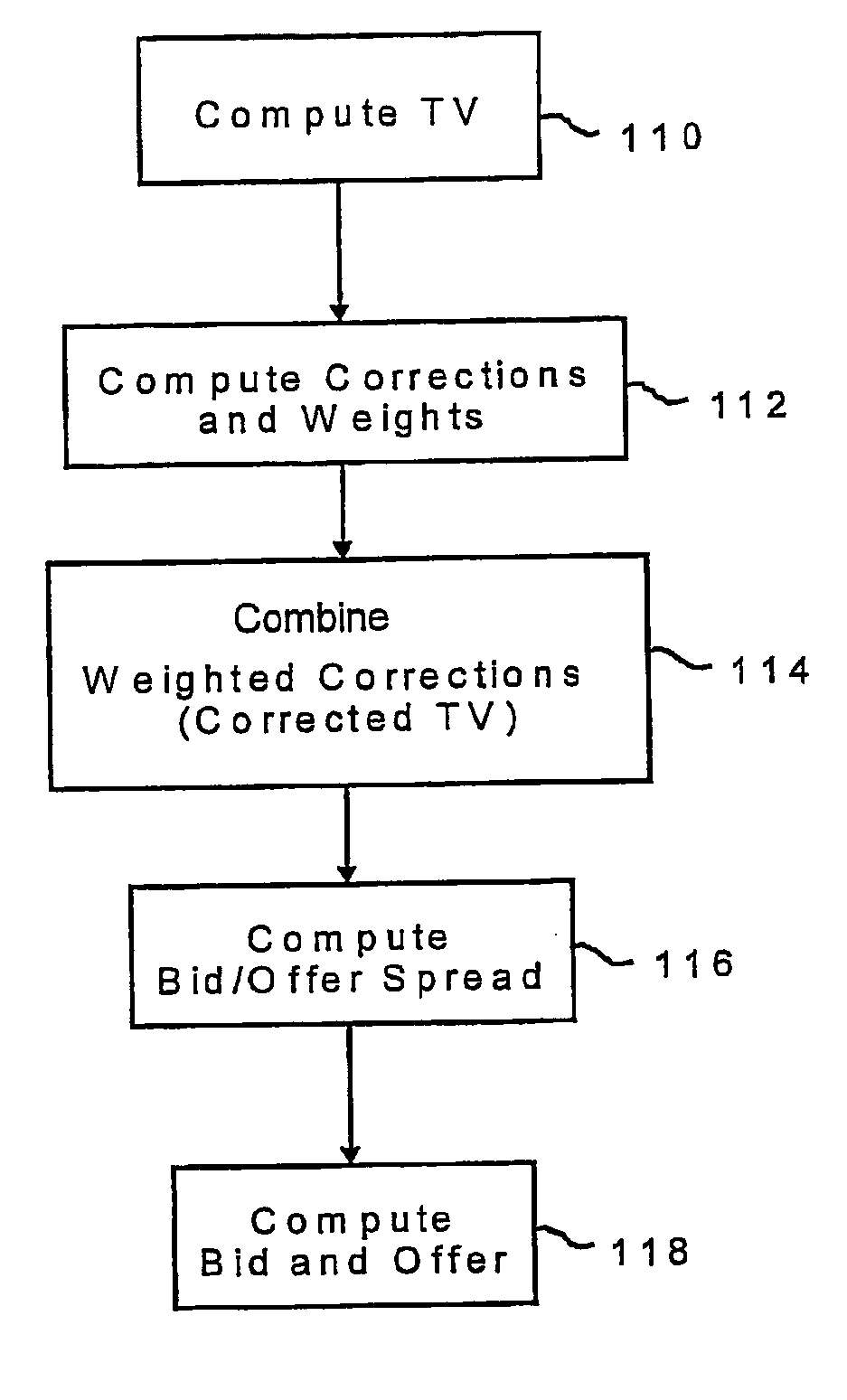

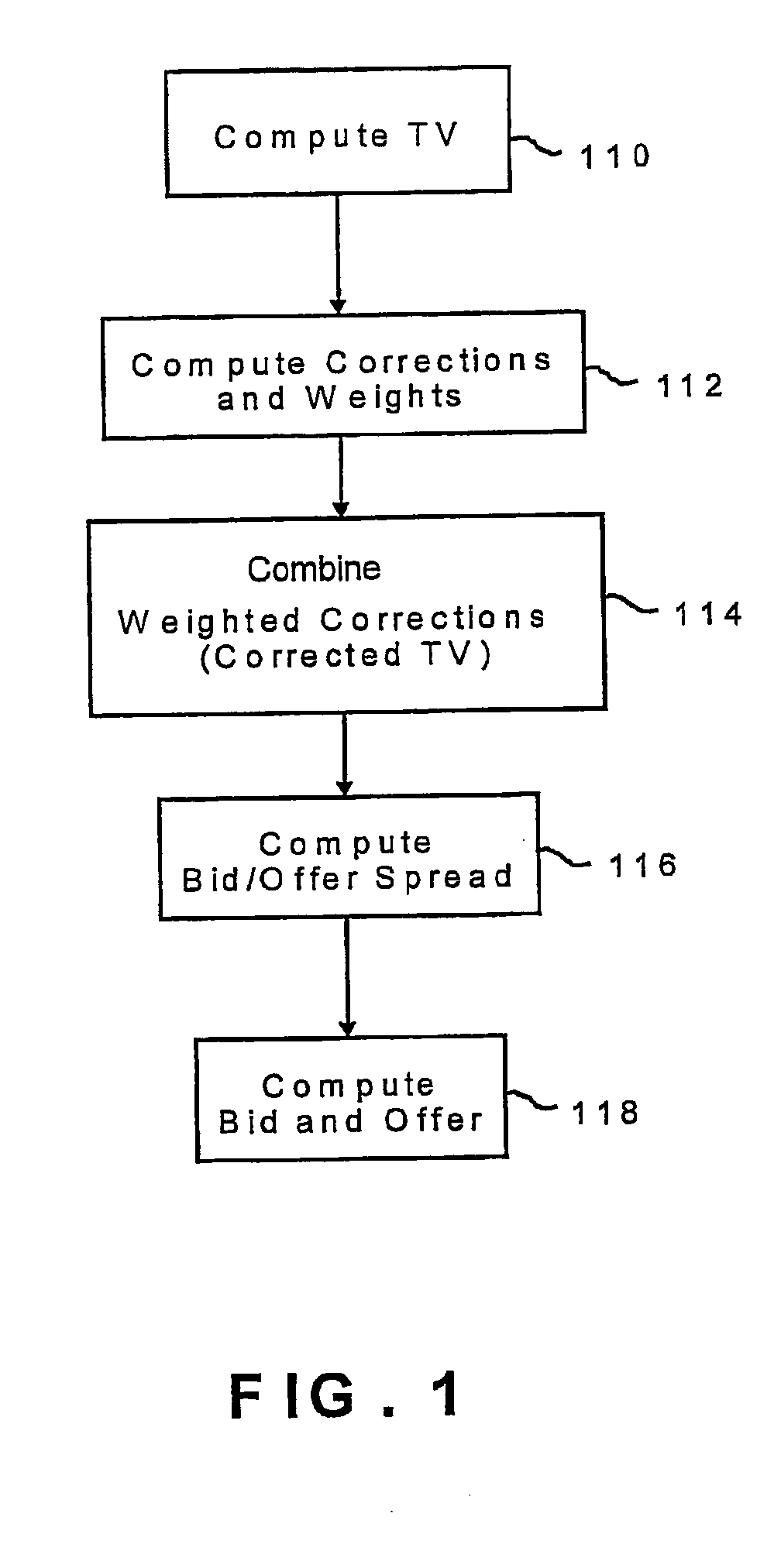

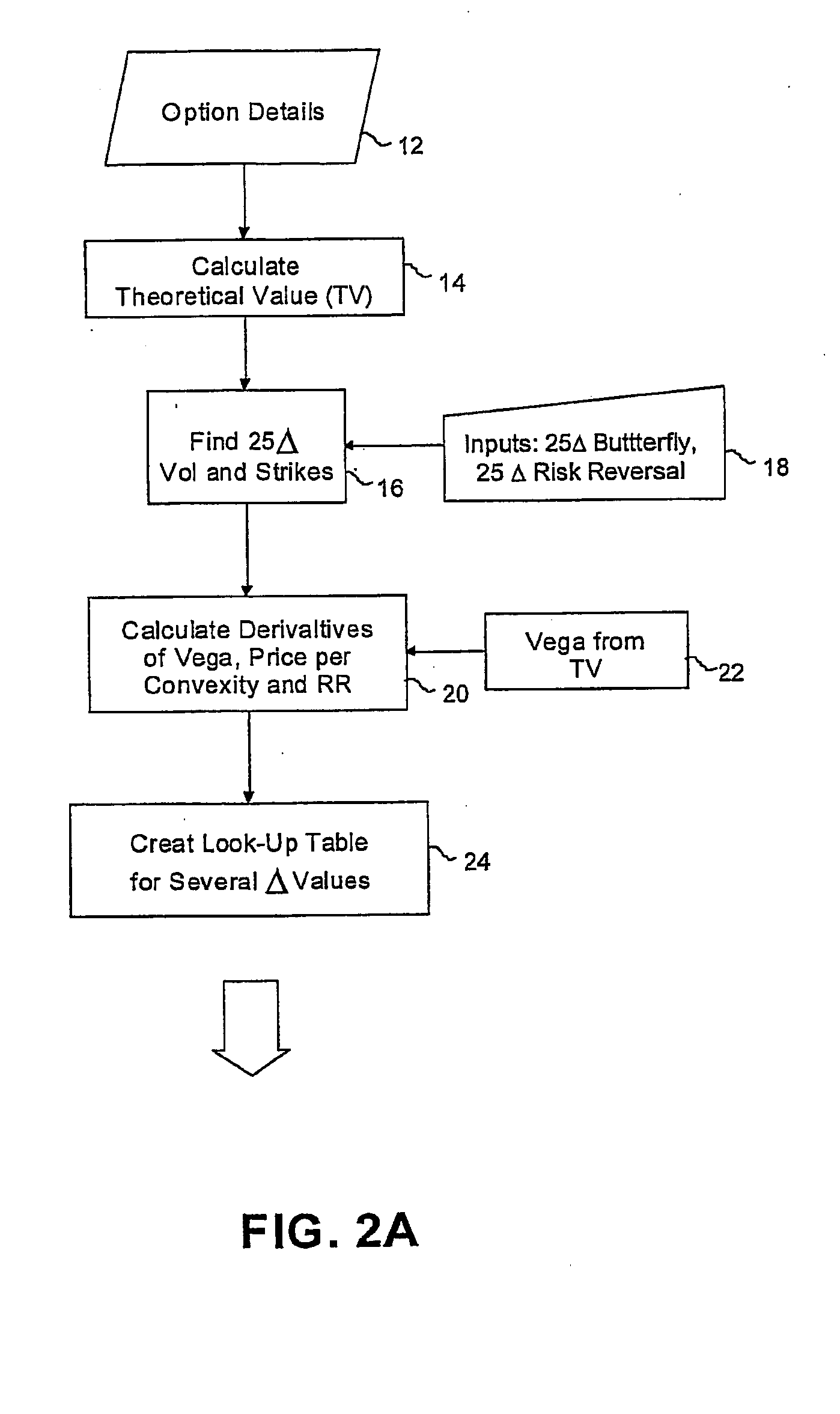

Method and system for pricing financial derivatives

ActiveUS20050027634A1Accurately determineFair priceFinanceSpecial data processing applicationsPrice differenceComputer science

A method for providing a bid price and / or an offer price of an option relating to an underlying asset, the method including the steps of receiving first input data corresponding to a plurality of parameters defining the option, receiving second input data corresponding to a plurality of current market conditions relating to the underlying value, computing a corrected theoretical value (CTV) of the option based on the first and second input data, computing a bid / offer spread of the option based on the first and input data, computing a bid price and / or an offer price of the option based on the corrected TV and the bid / offer spread, and providing an output corresponding to the bid price and / or the offer price of said option.

Owner:SUPERDERIVATIVES INC

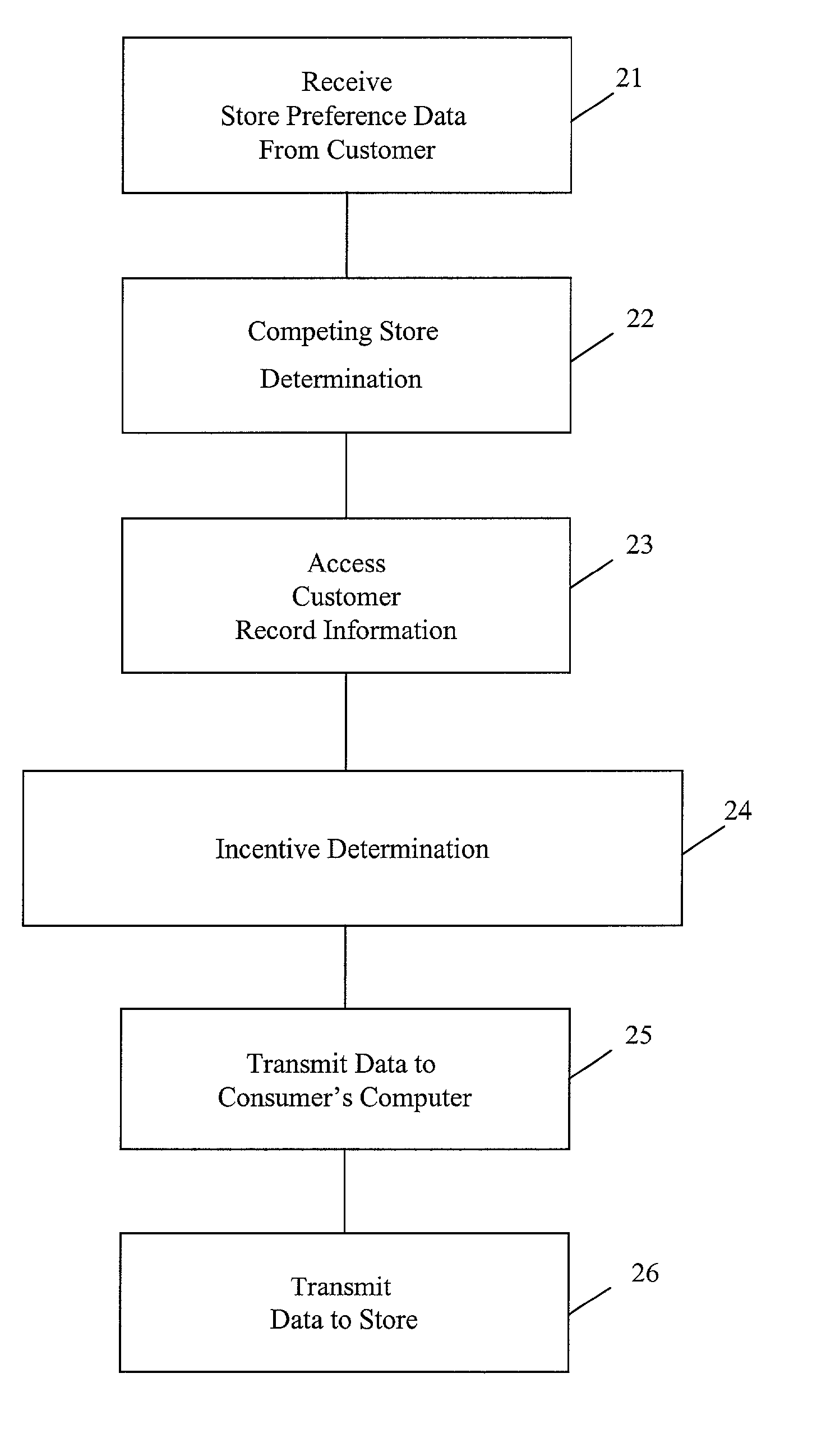

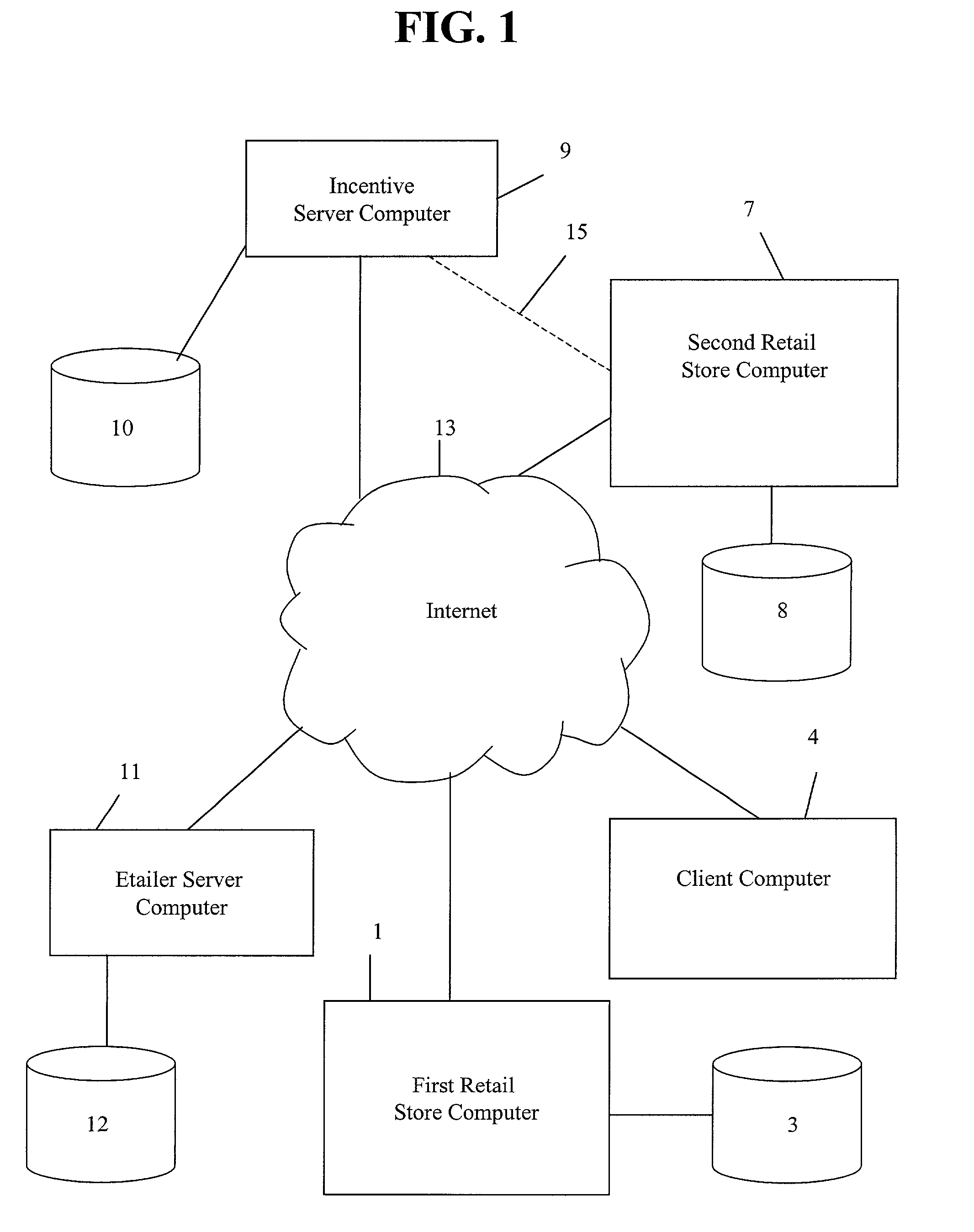

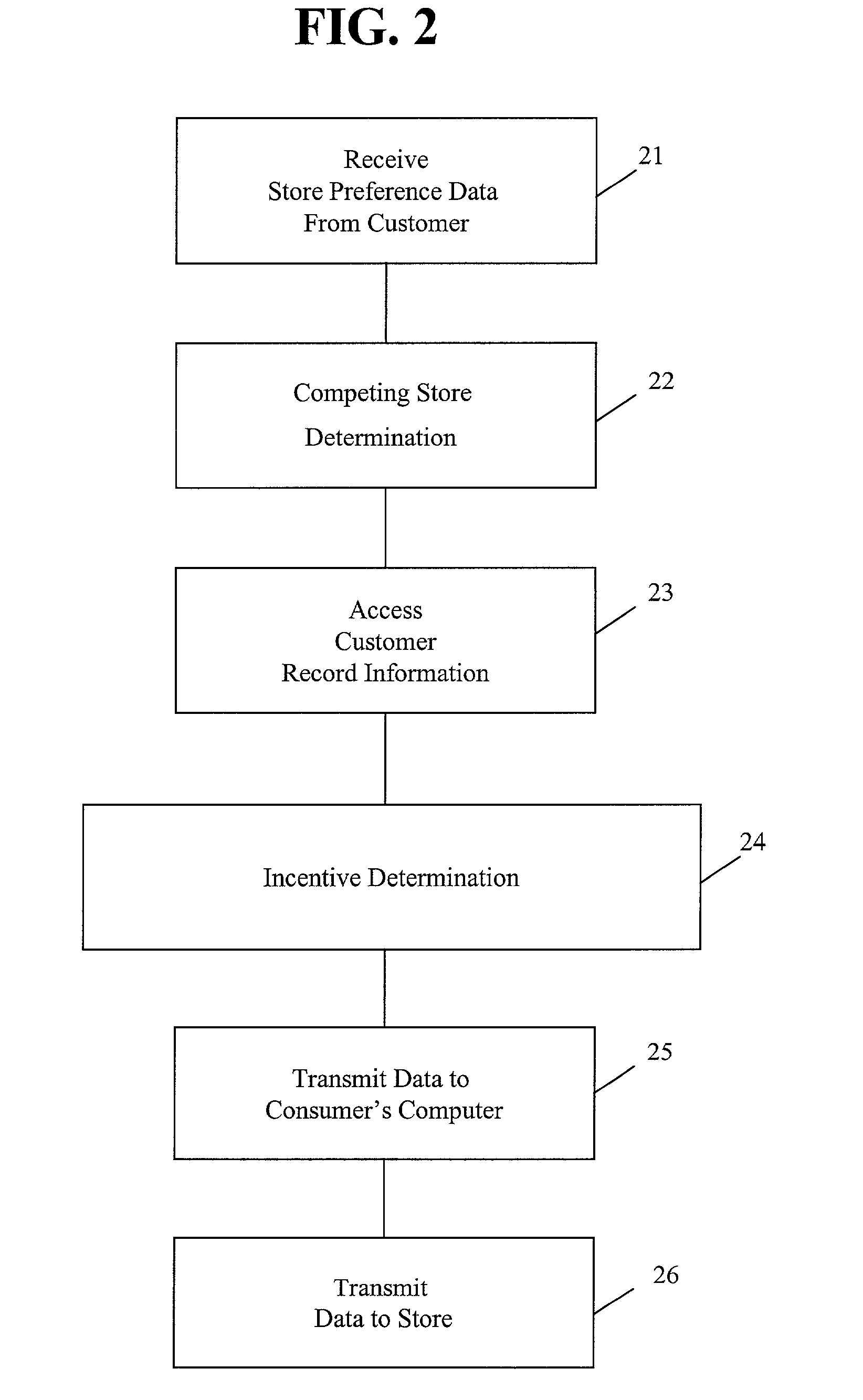

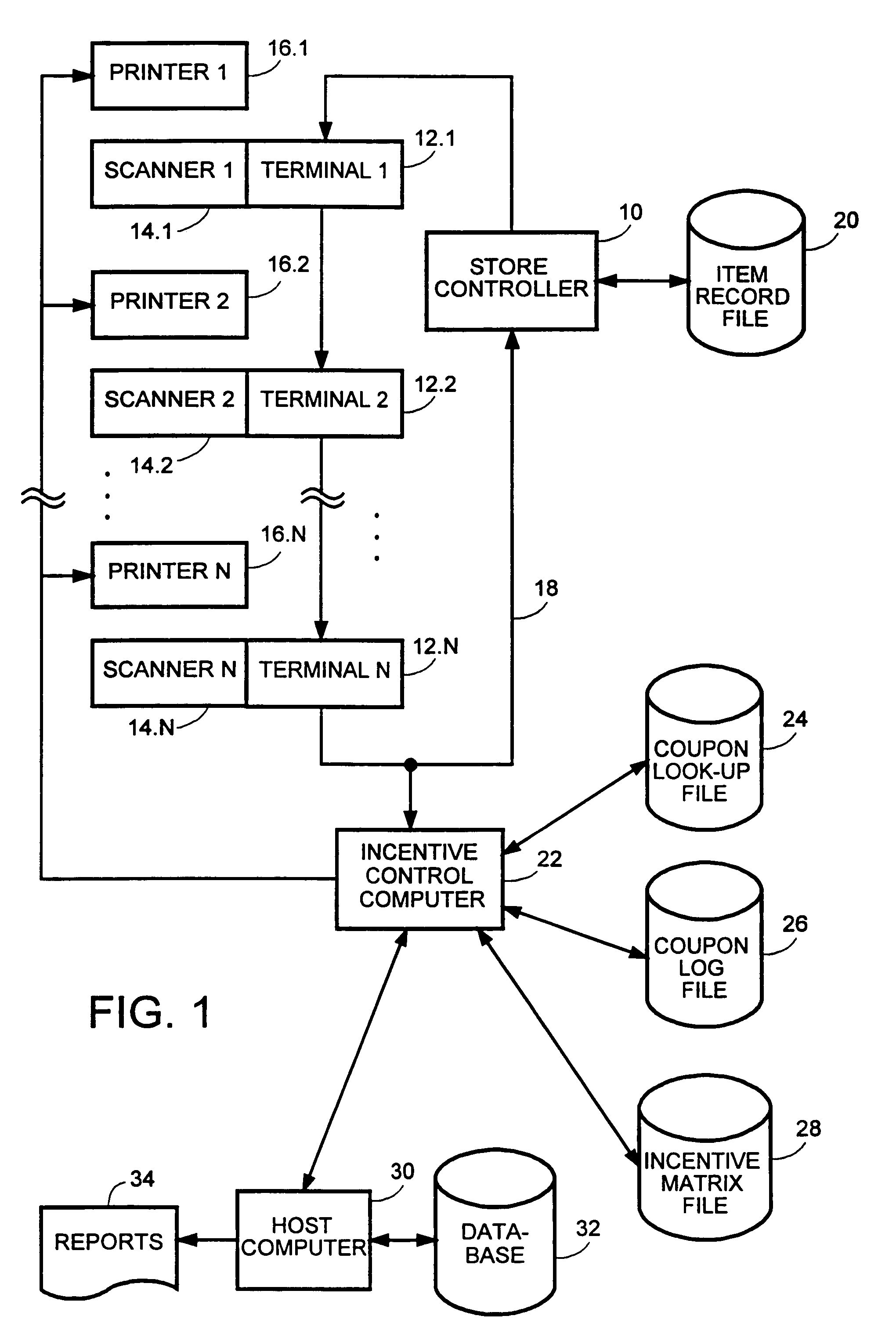

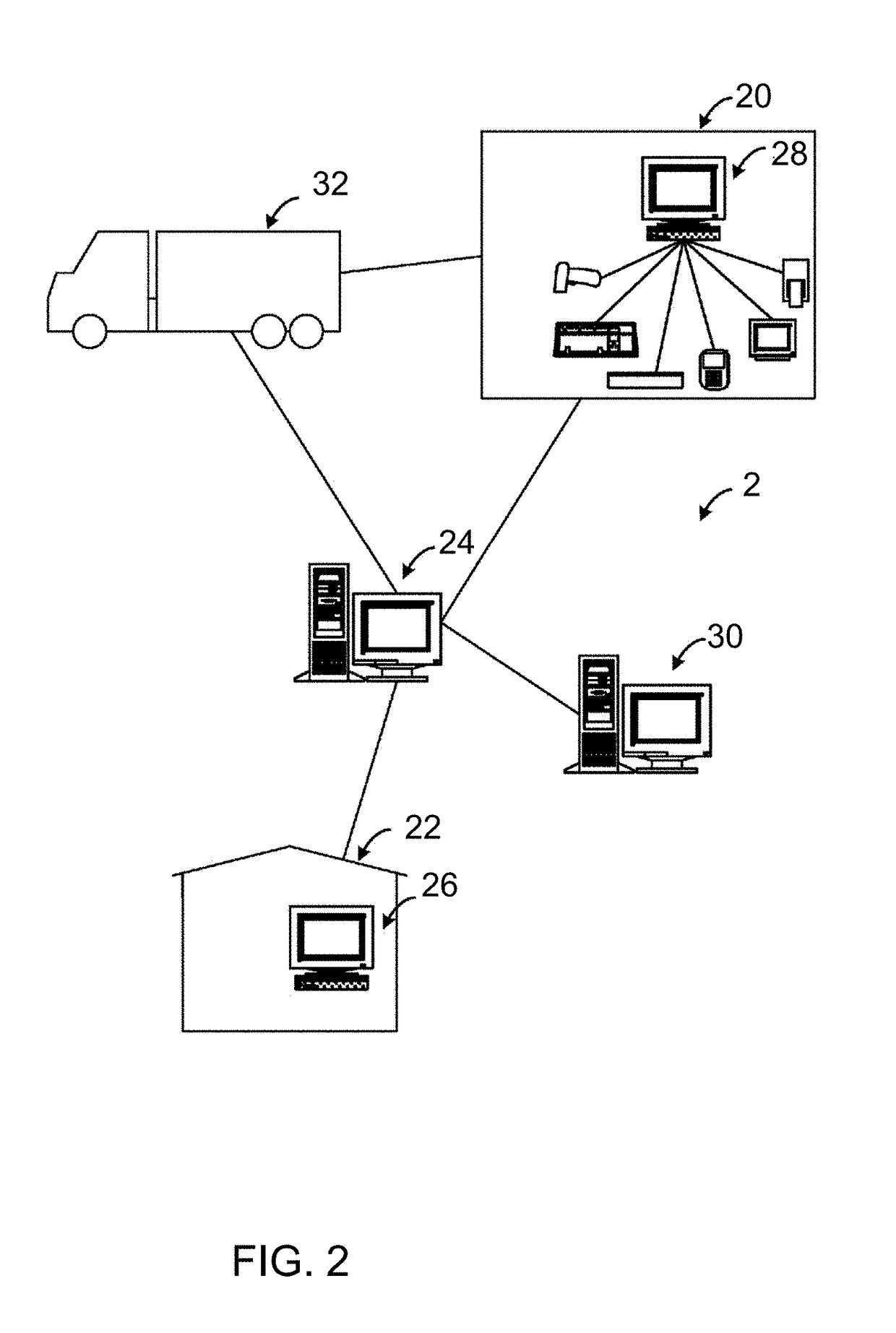

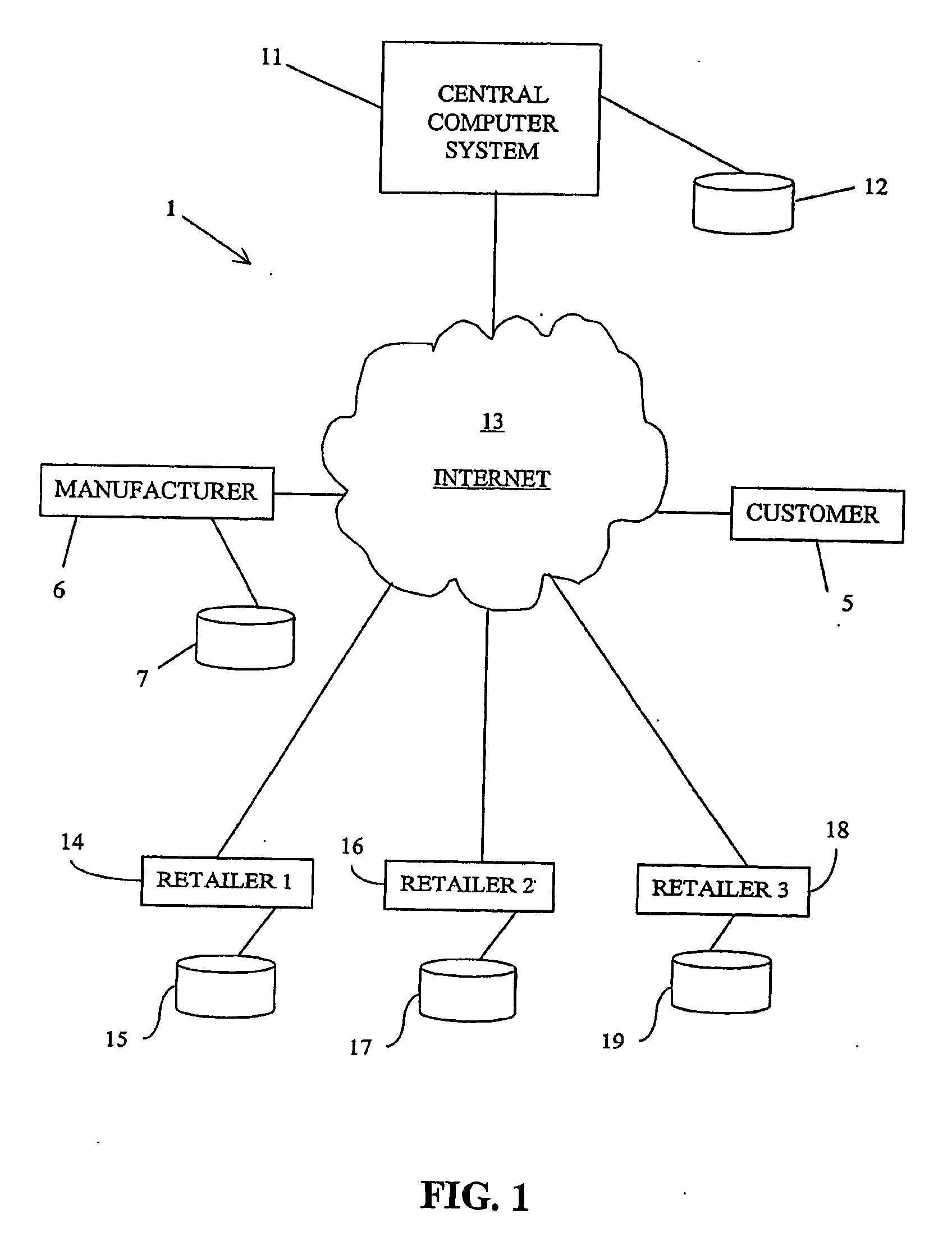

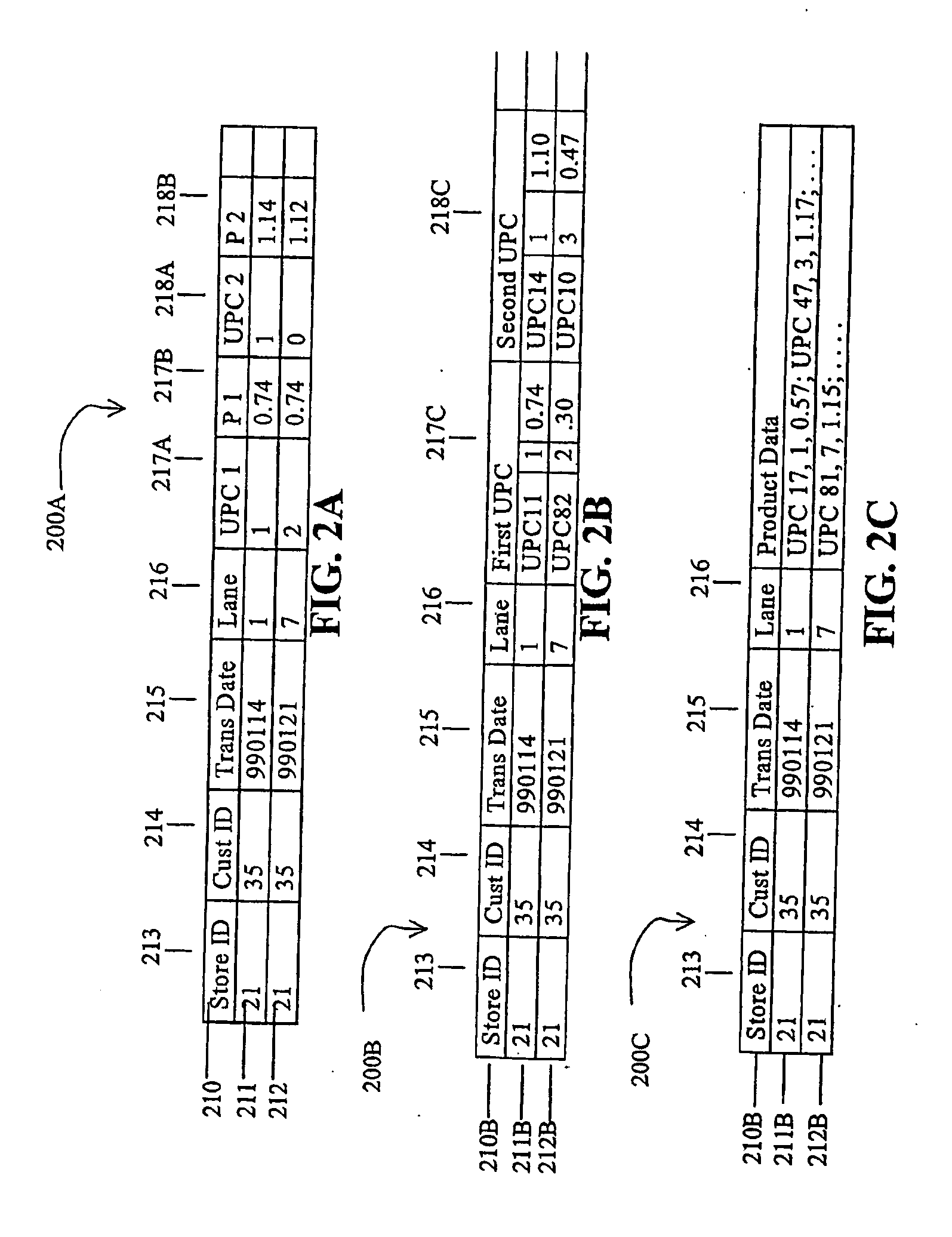

Cross-retail store individualized price differential network system and method

The invention provides a computer network system and a method of using the system to influence consumer retail store shopping behavior by offering a consumer an incentive to shop at first retail store if data analysis indicates that the consumer is likely to shop at a store competing for the consumer's business. The invention also provides means for determining the value and conditions imposed upon the consumer receiving the incentive offered based upon data indicating the differential value to the consumer in shopping at the competing retail store instead of the first retail store and data indicating the value to the first retail store of the consumer's anticipated purchase, if that purchase is made from the first retail store.

Owner:CATALINA MARKETING CORP

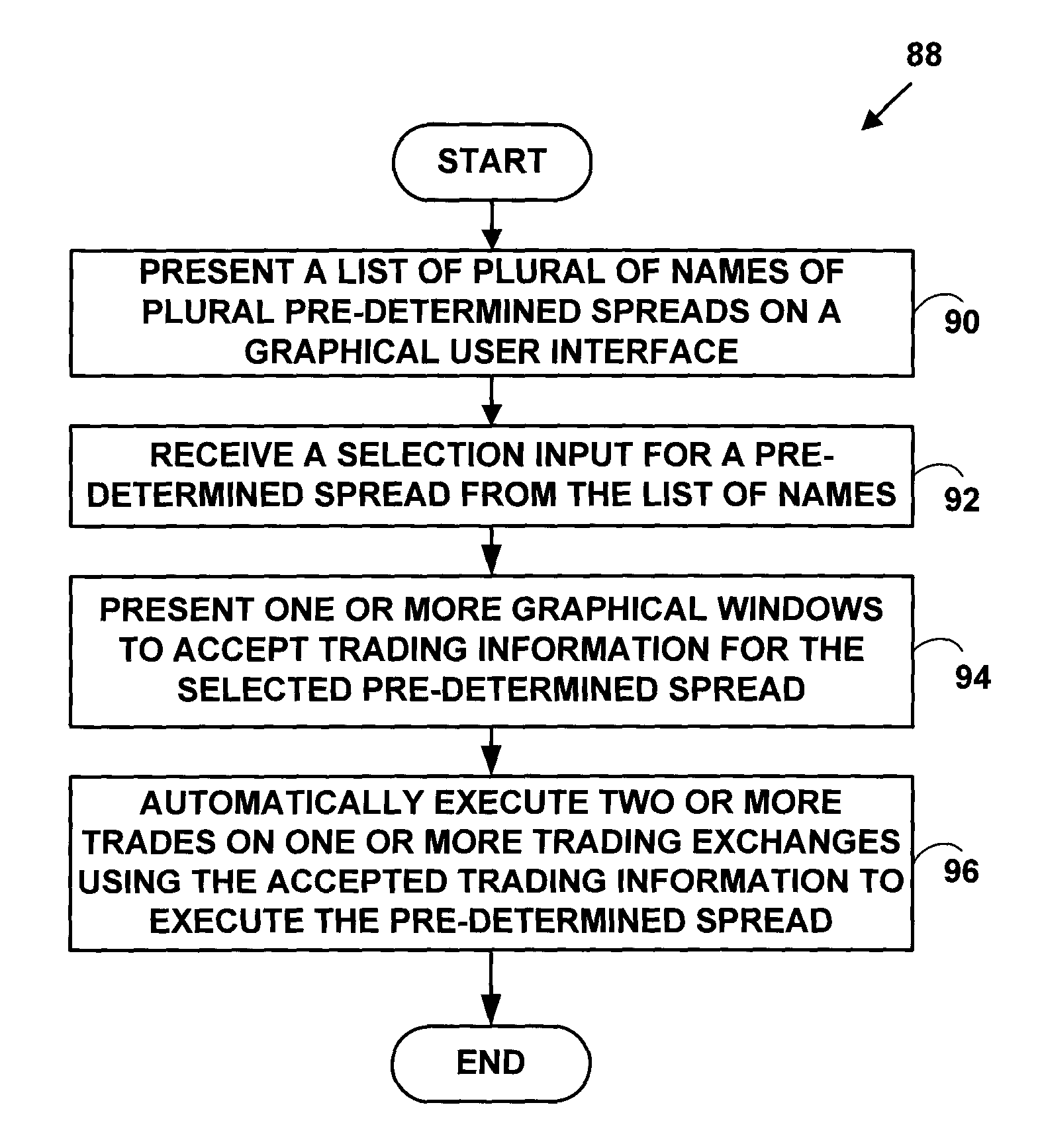

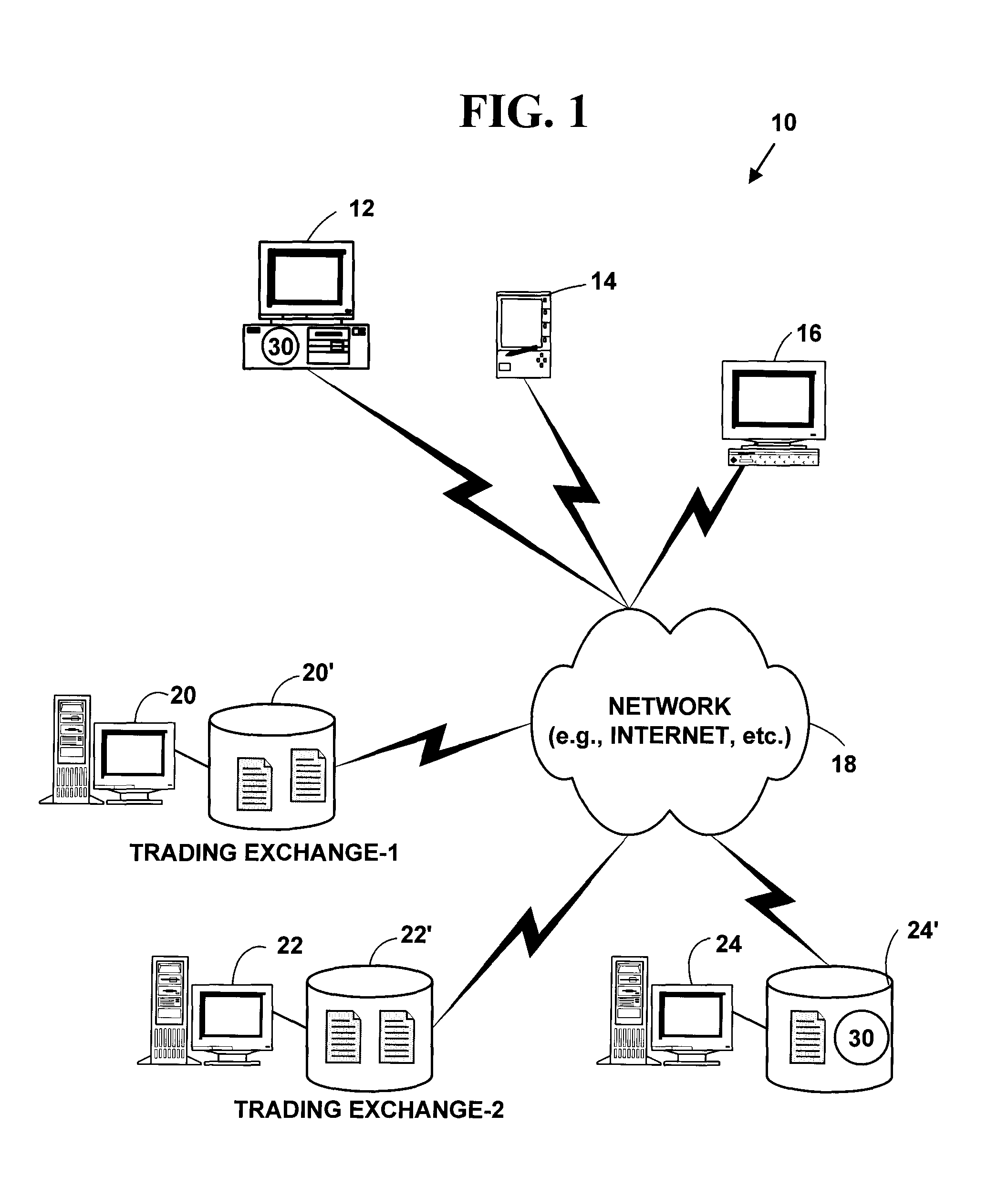

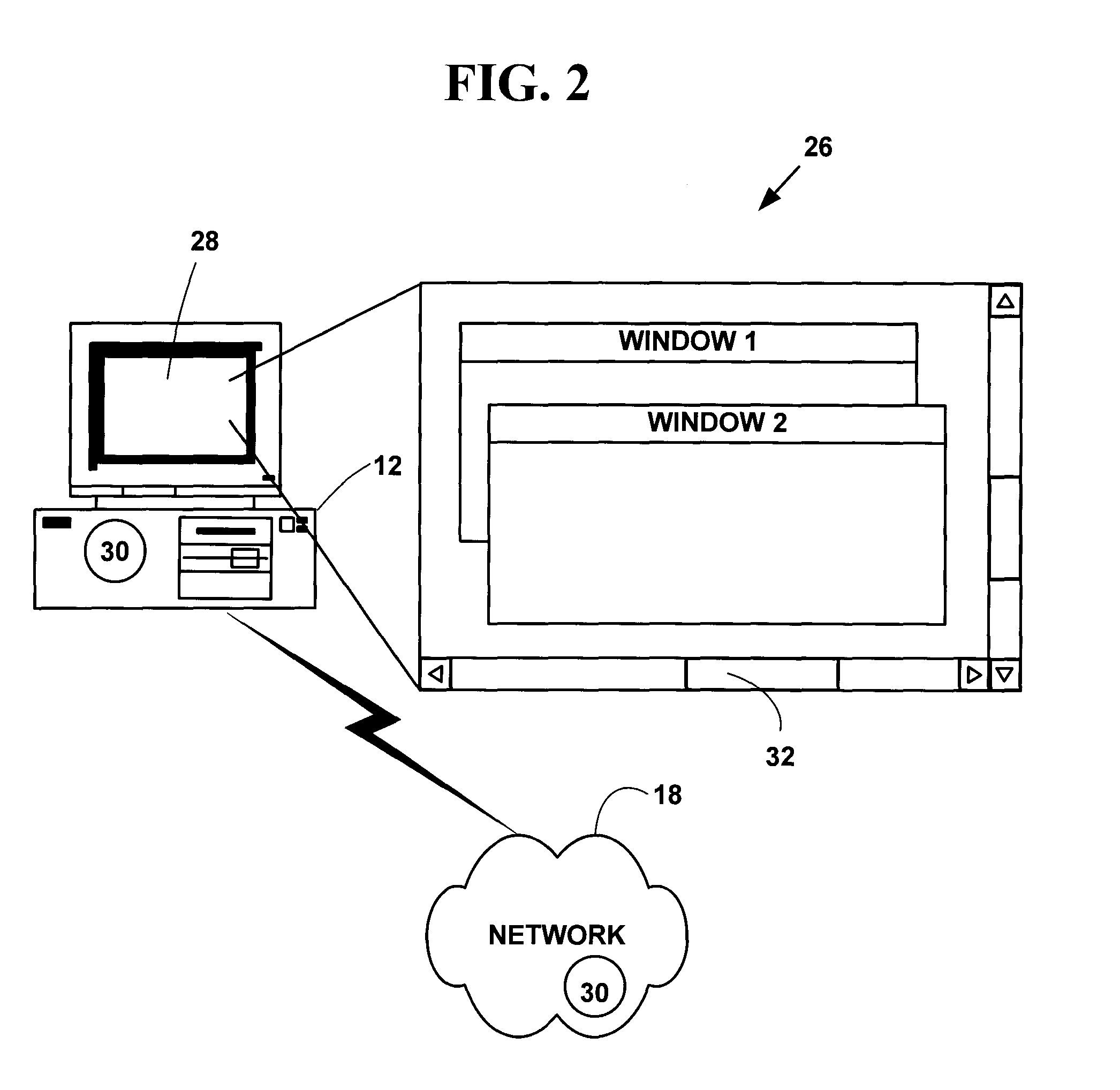

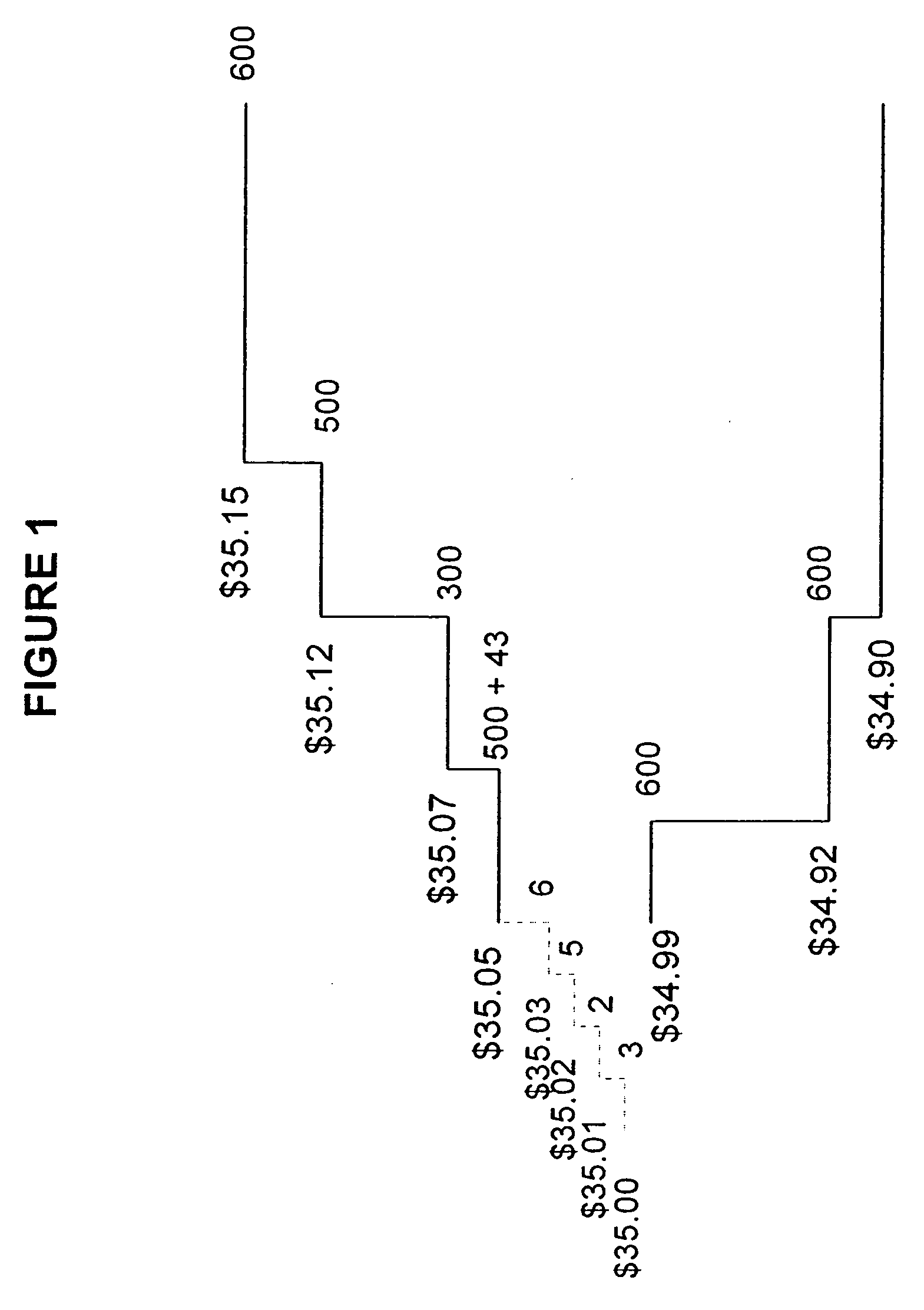

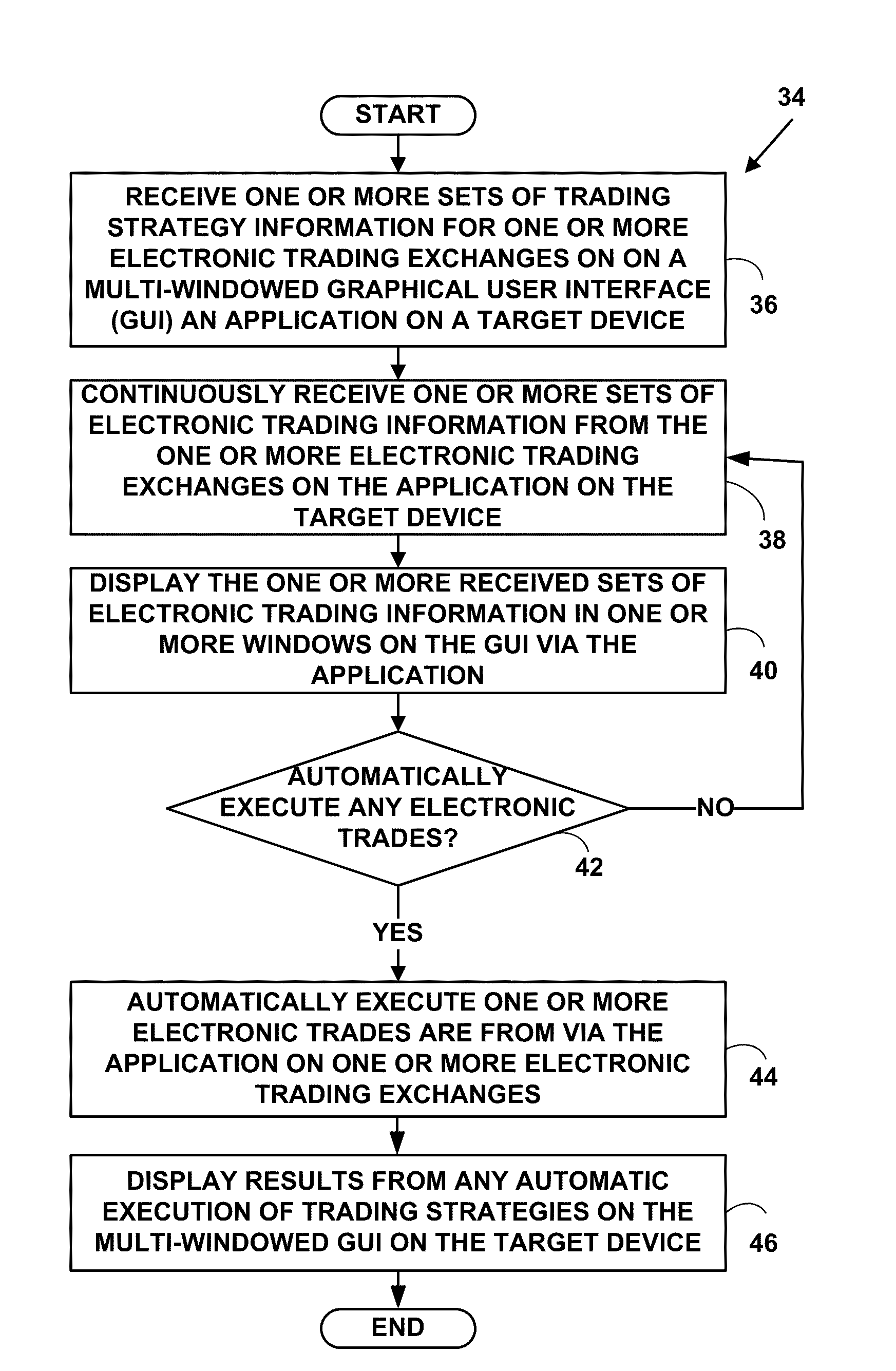

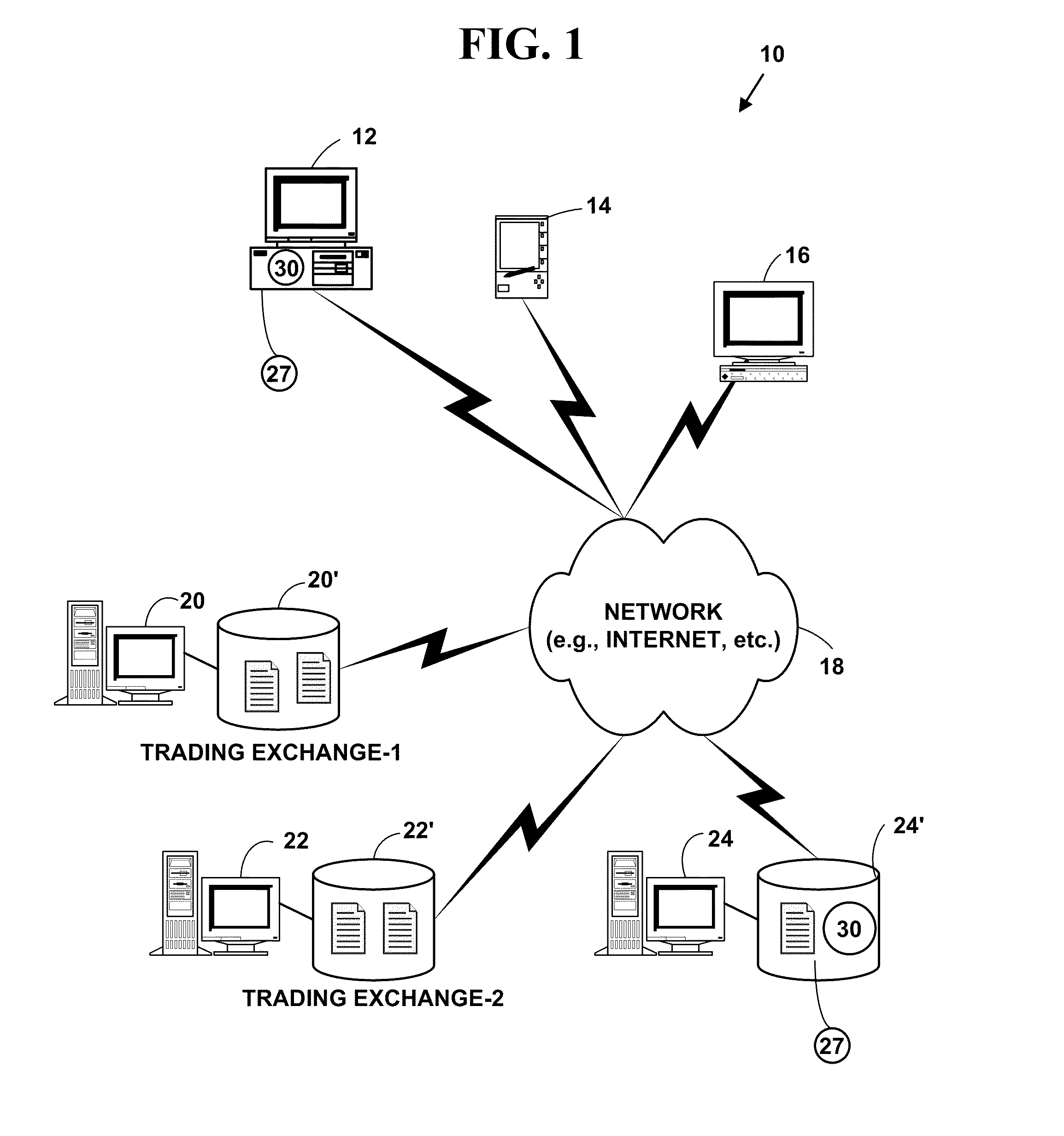

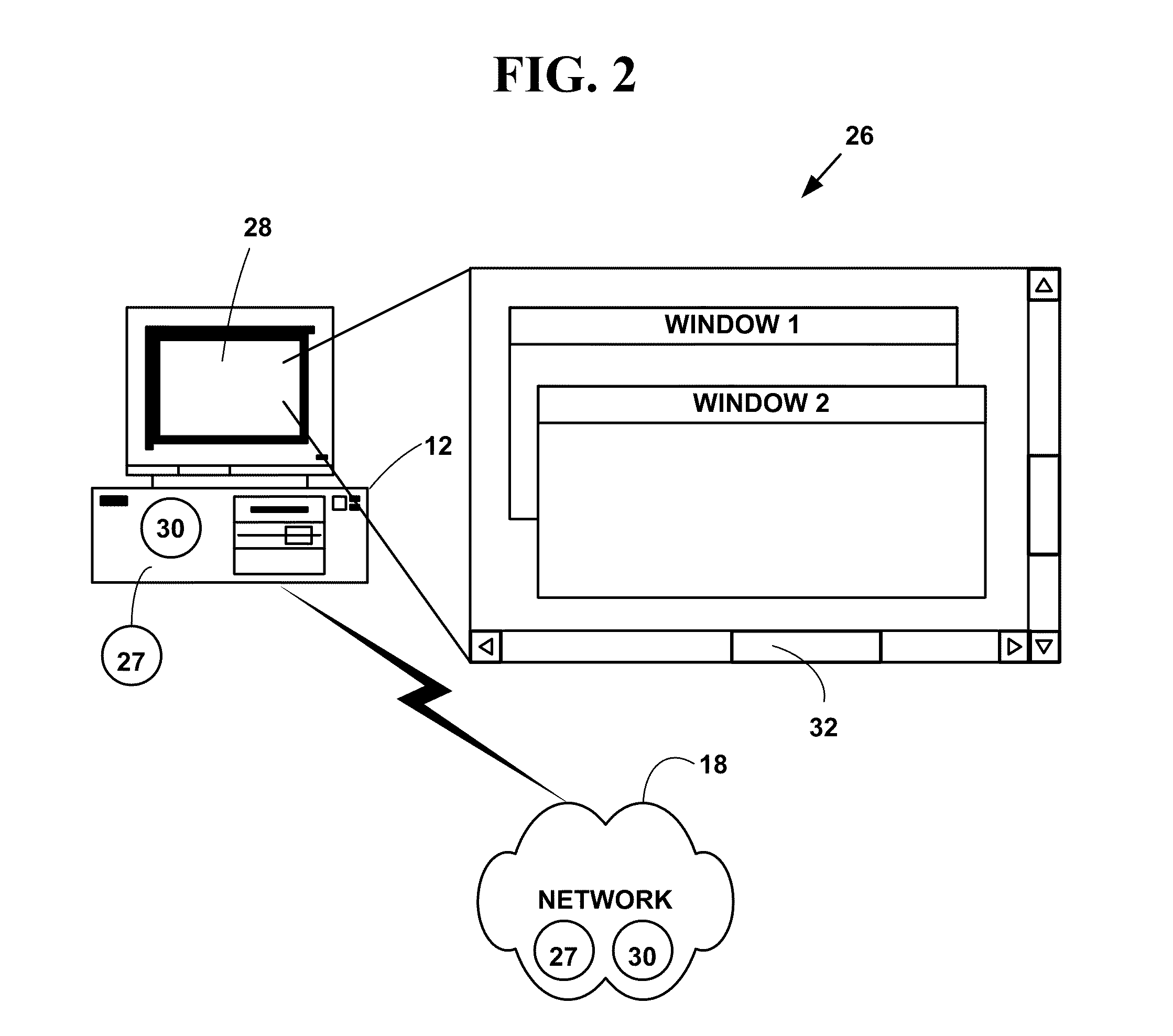

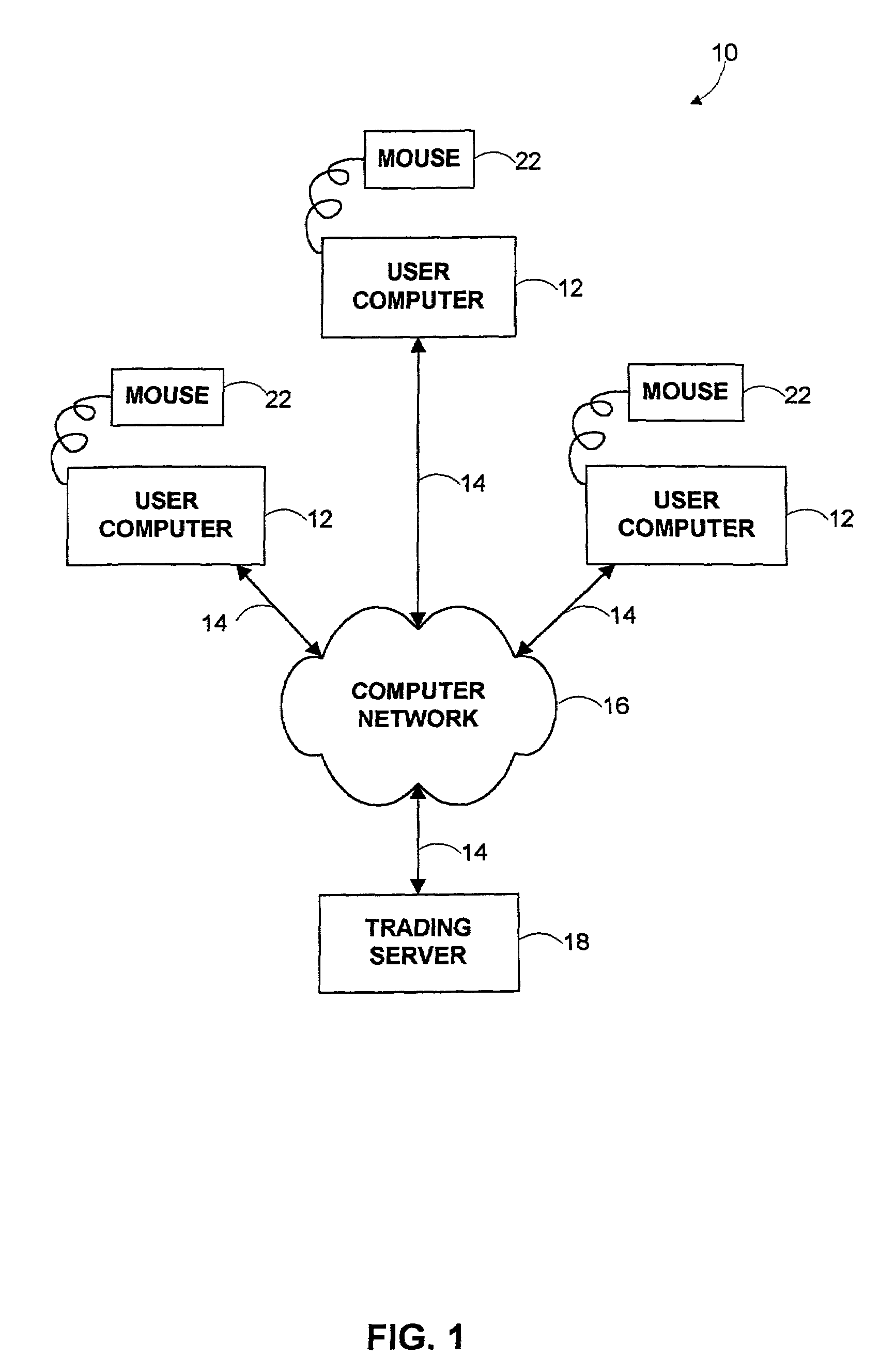

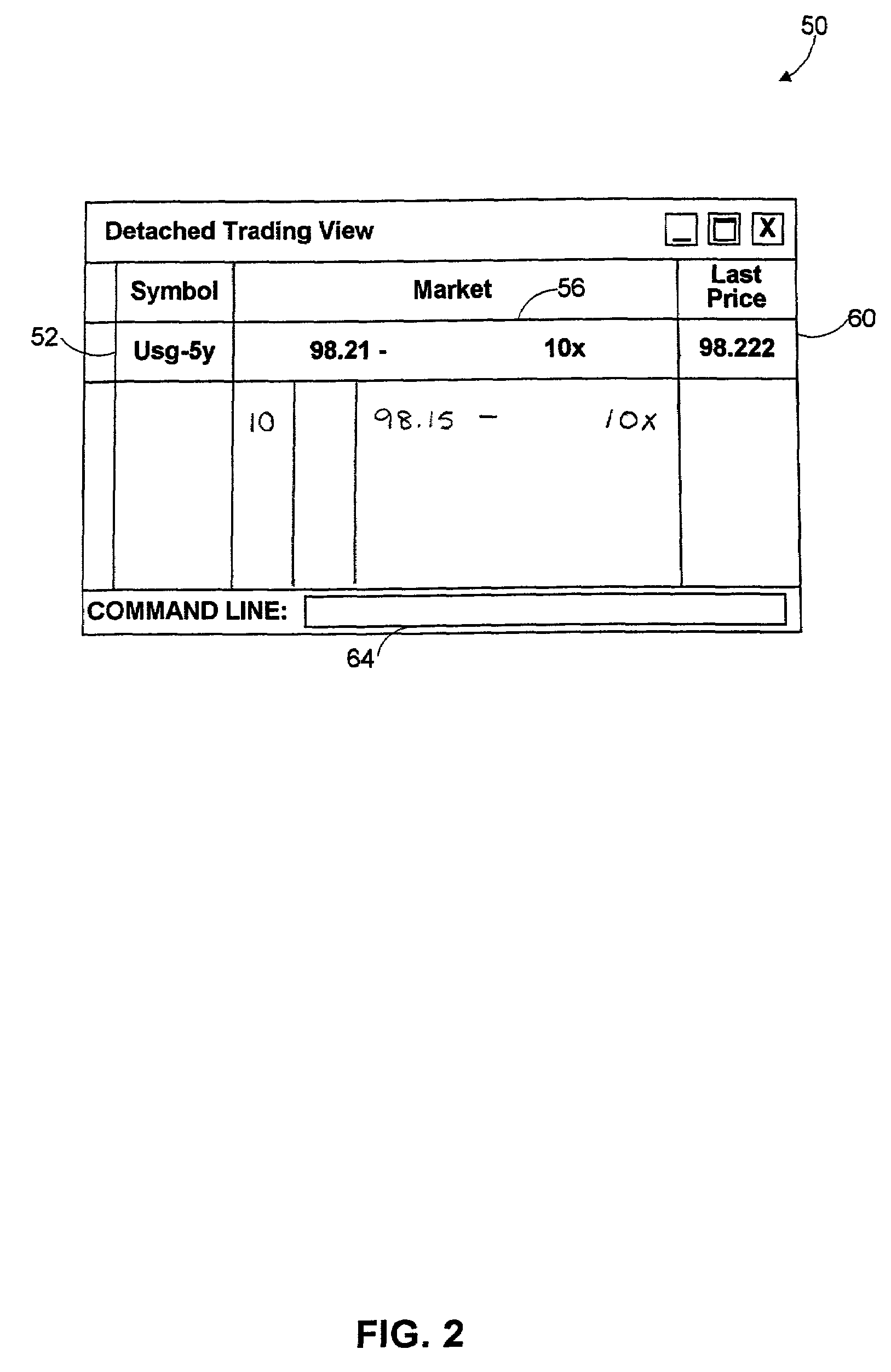

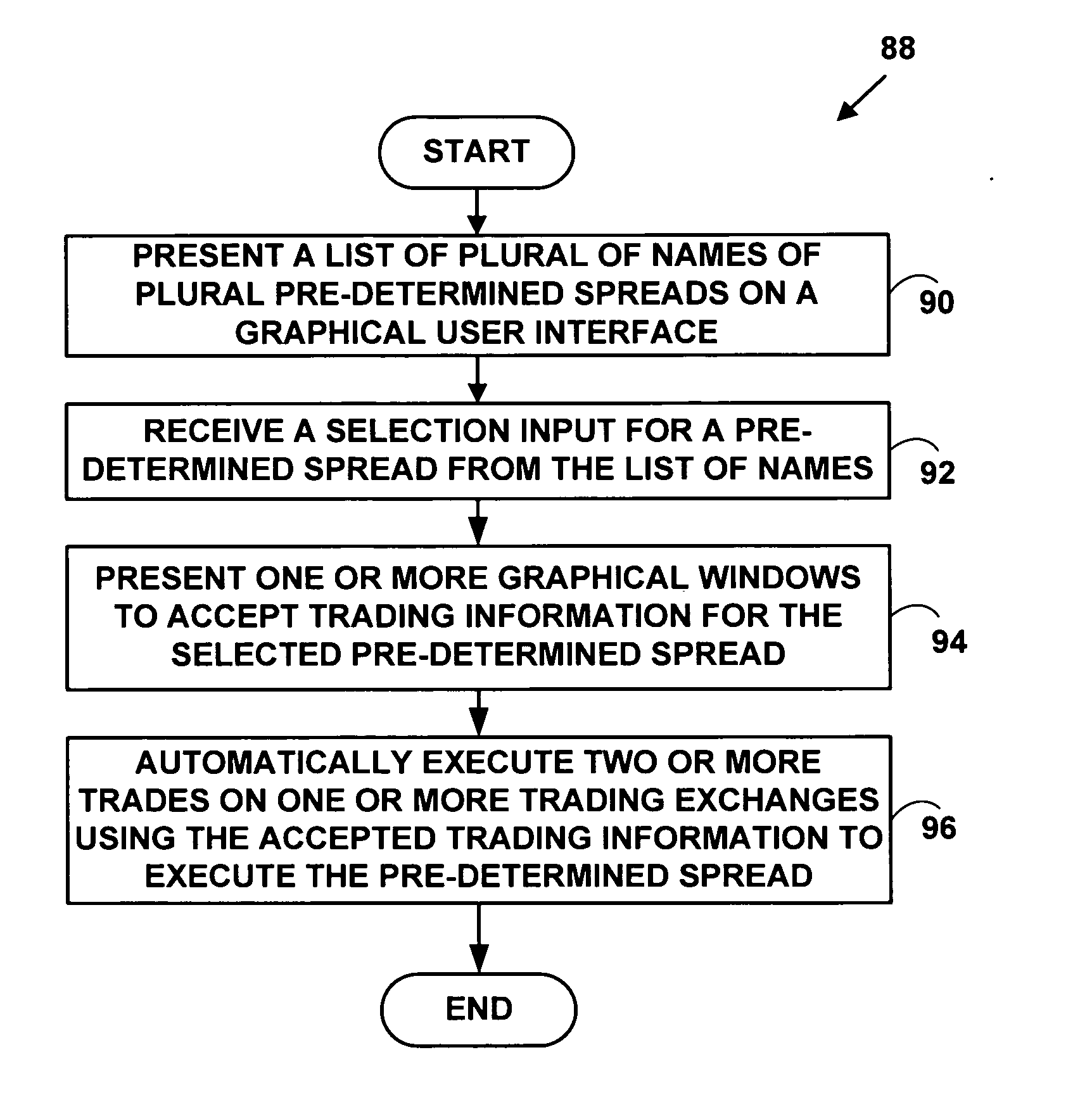

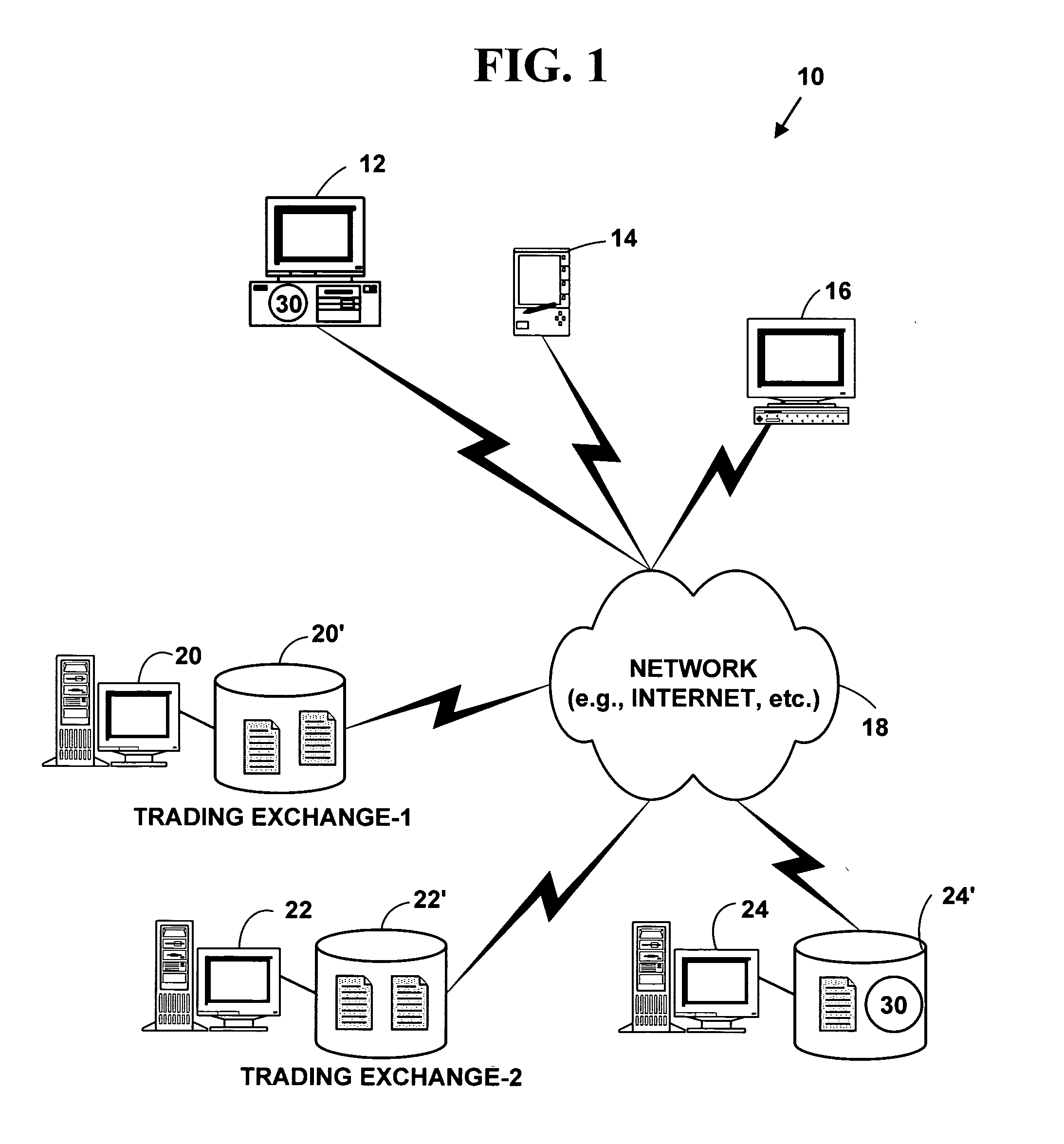

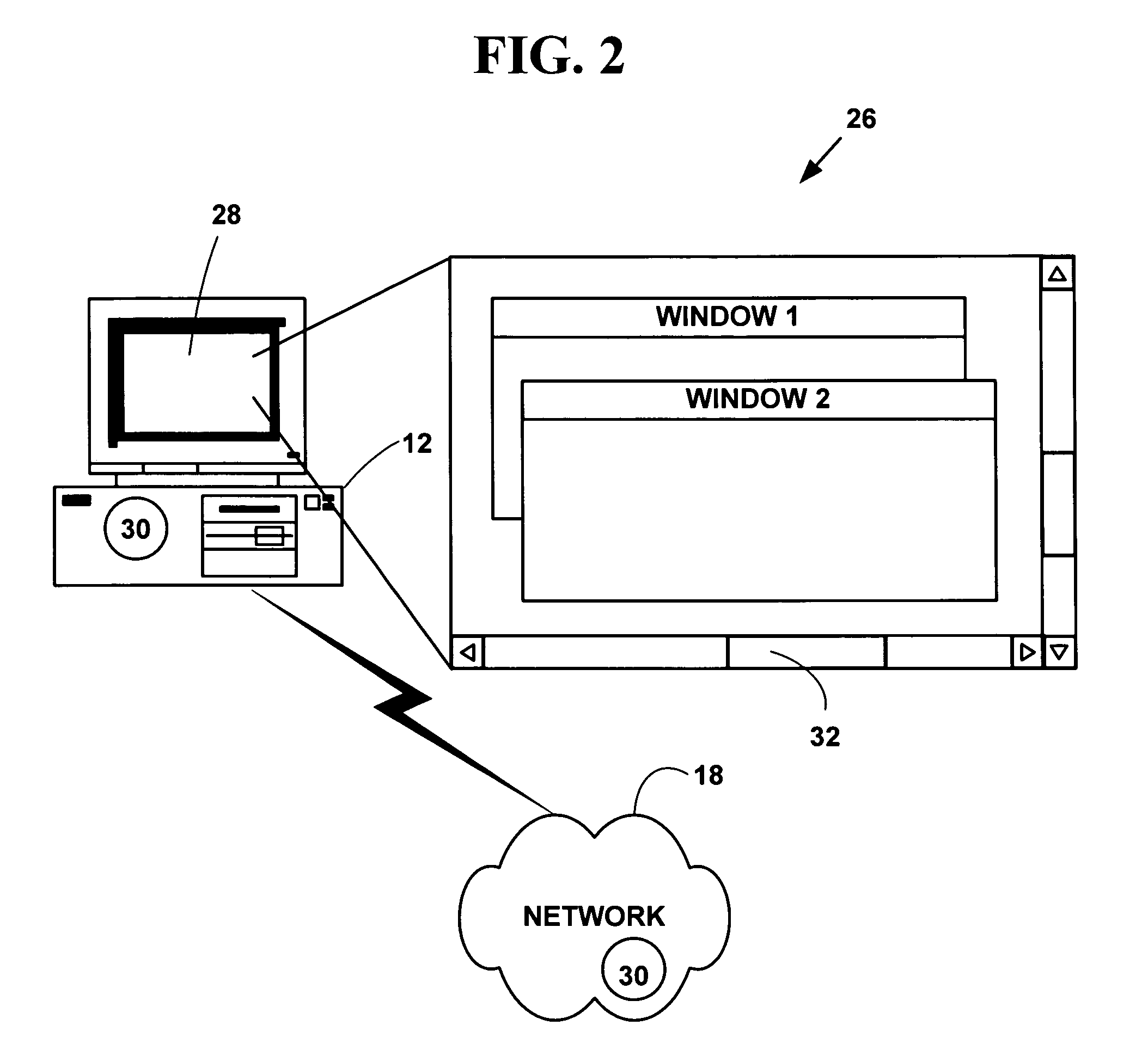

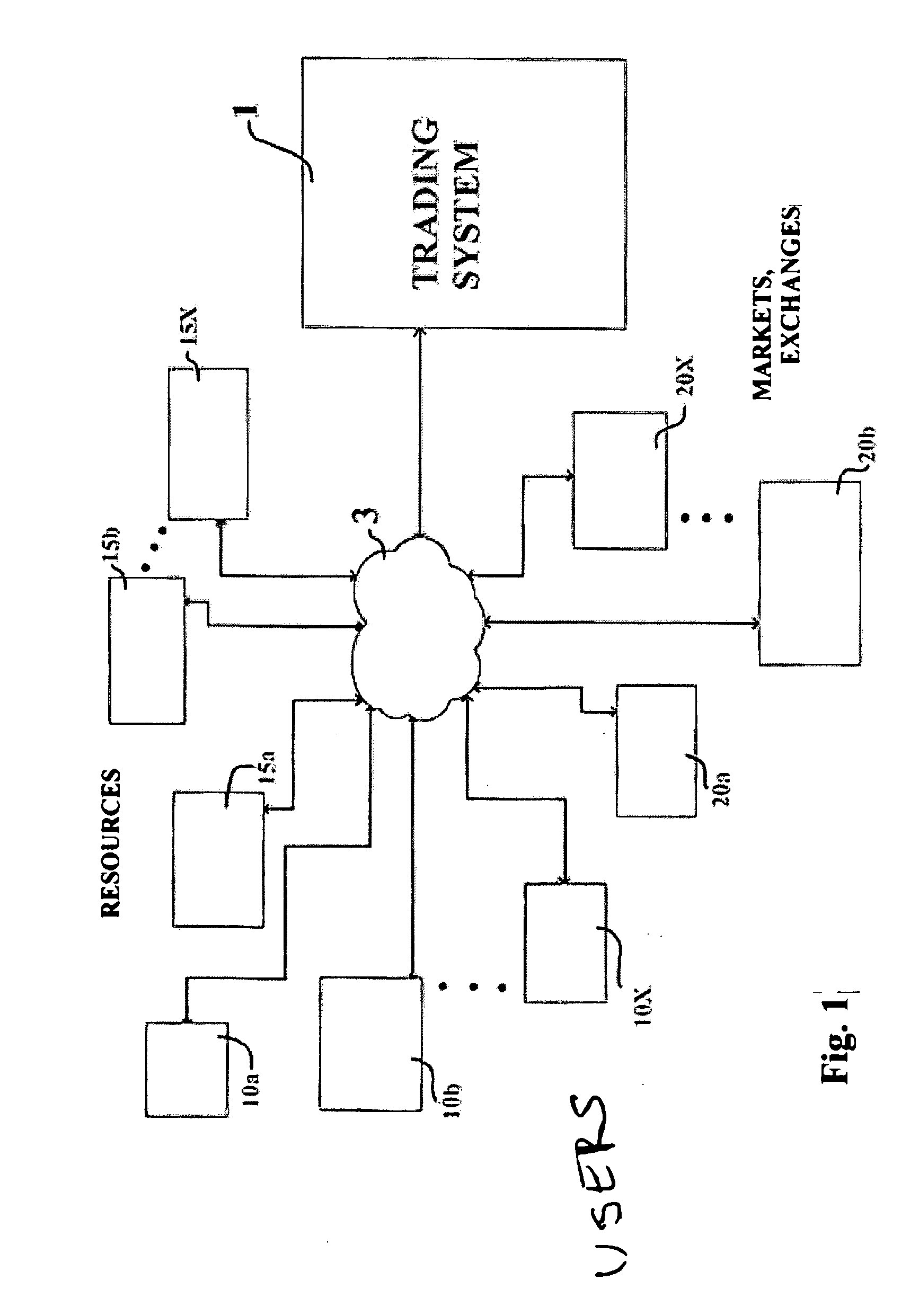

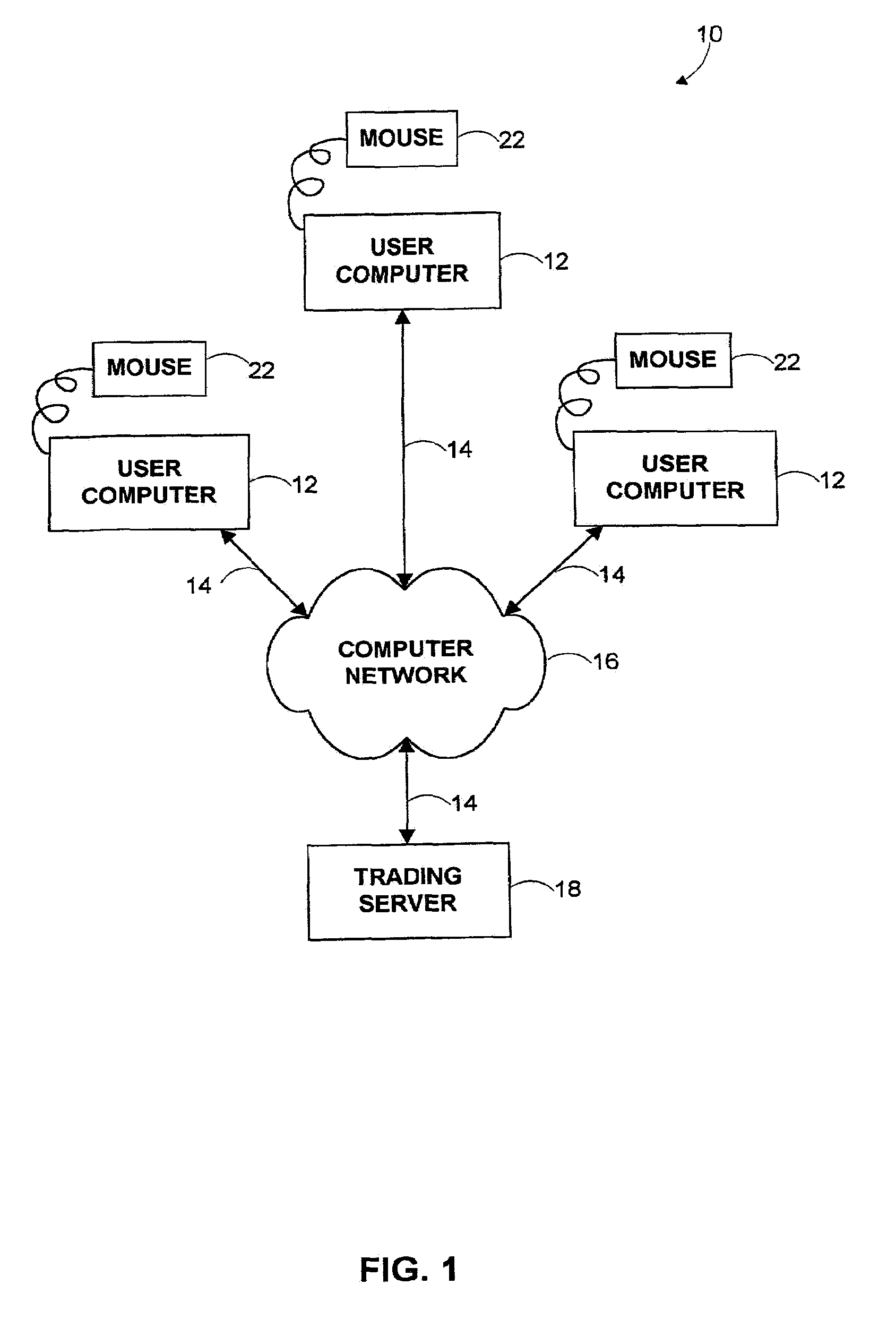

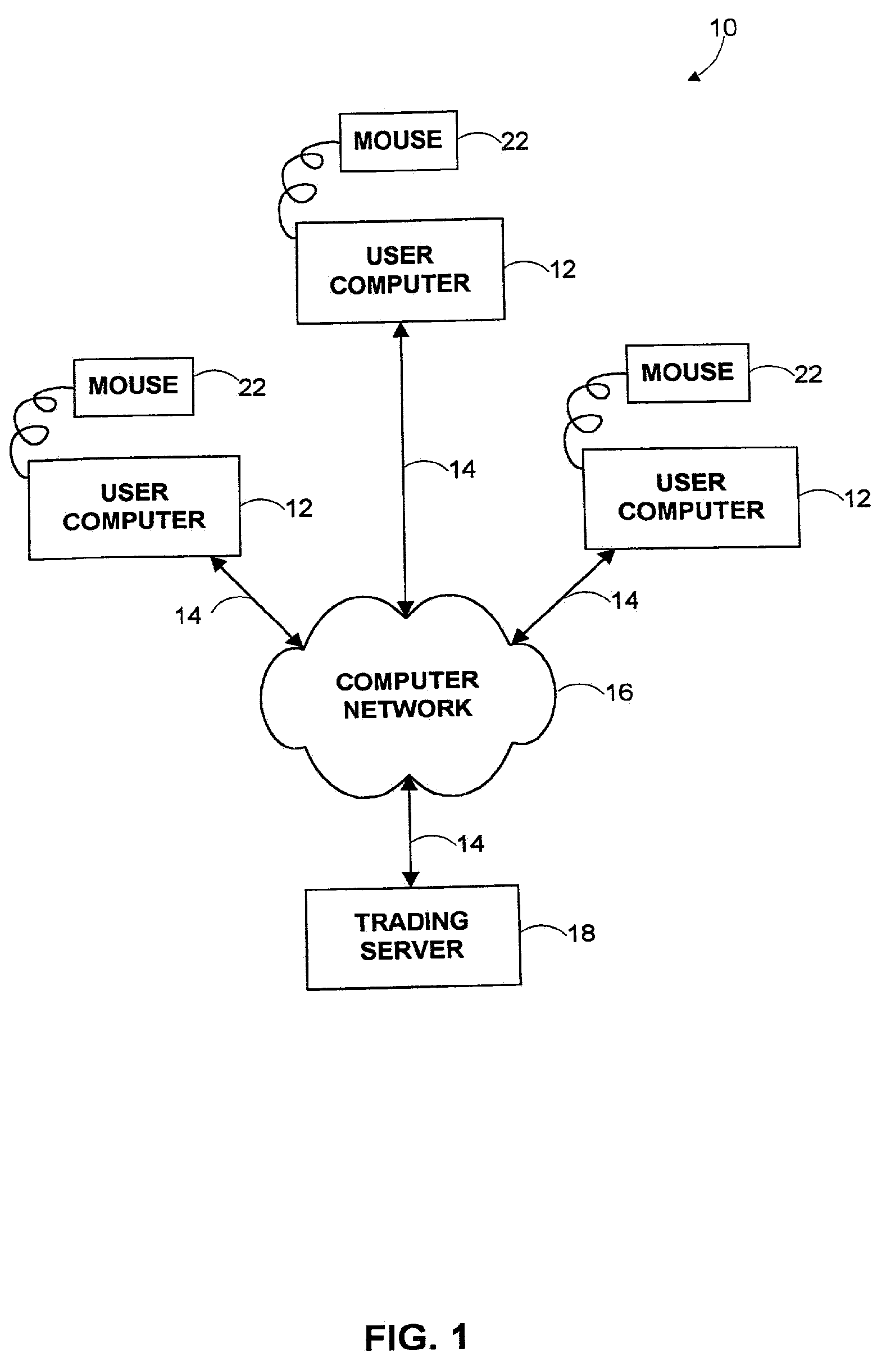

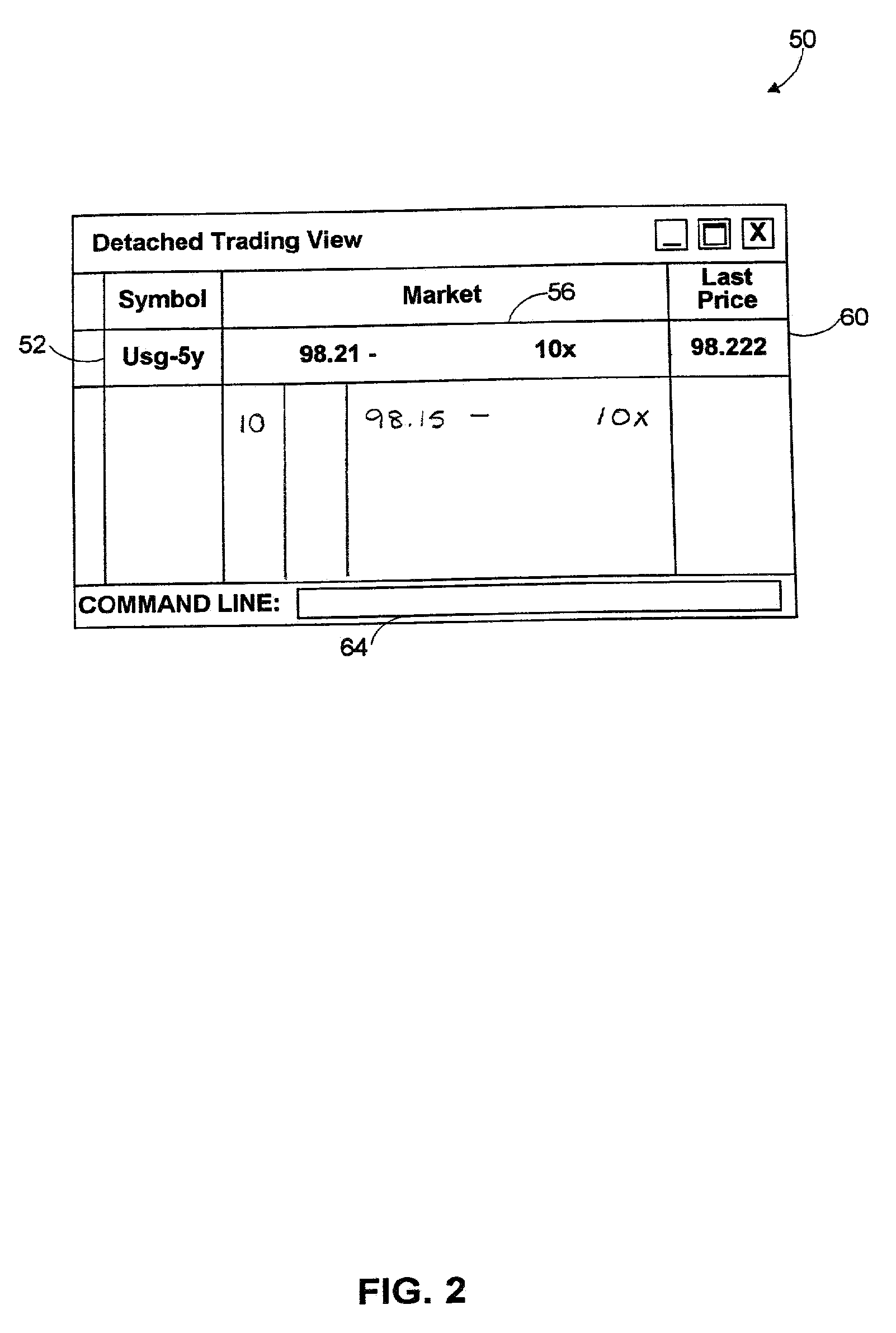

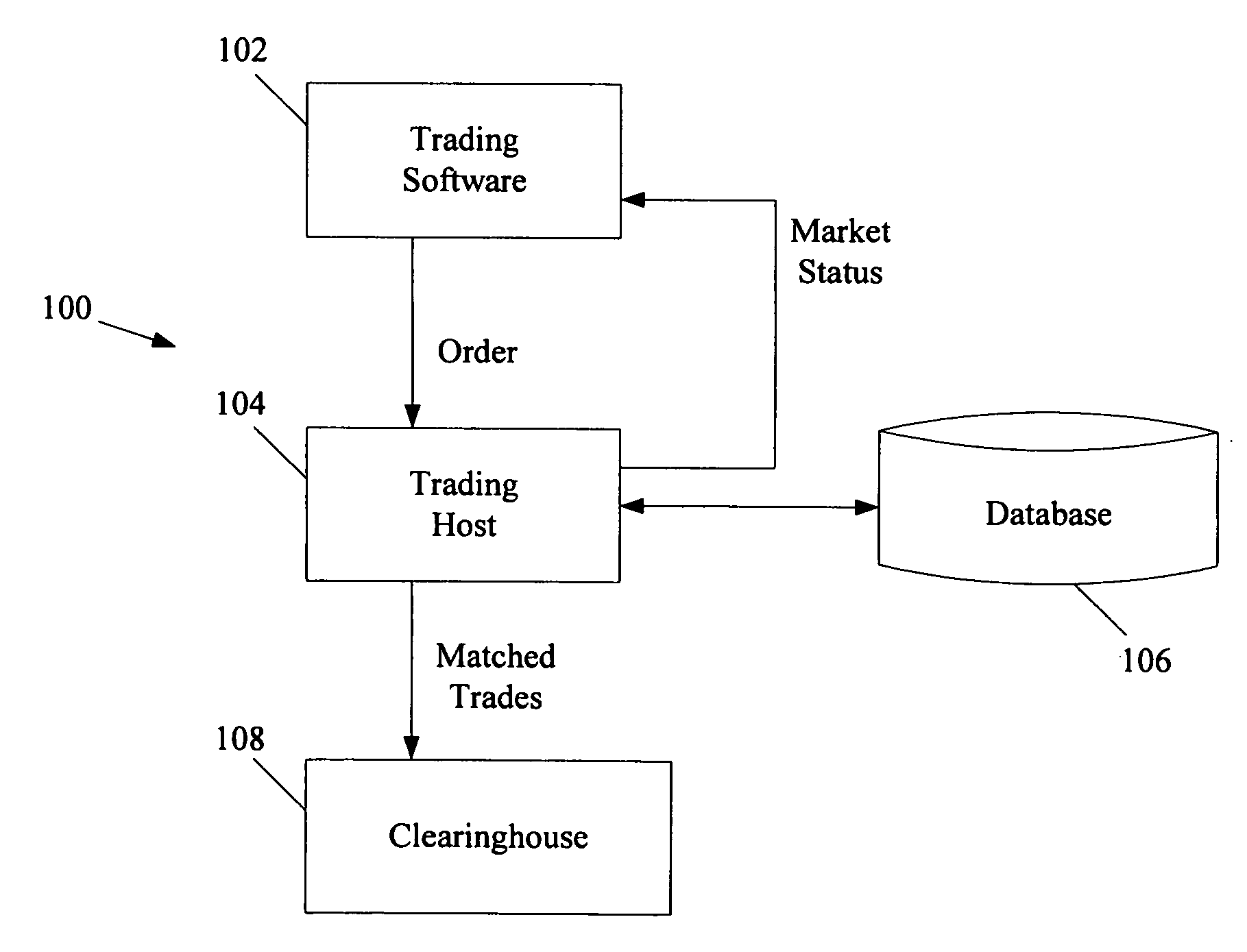

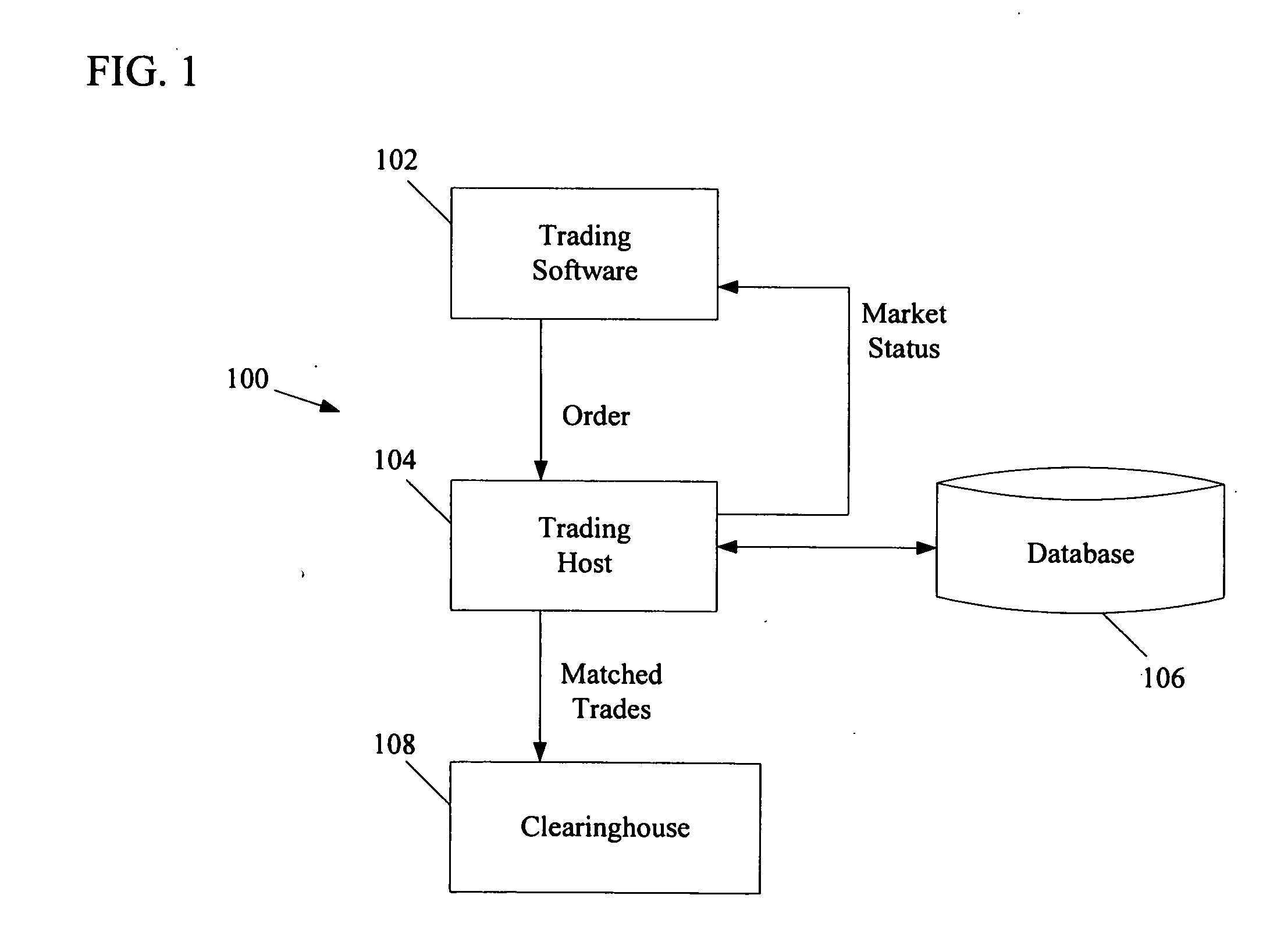

Method and system for automatically inputting, monitoring and trading spreads

A method and system for providing dynamic display of electronic trading information for trading spreads. The method and system allow spreads to be automatically inputted, executed and monitored on one or more trading exchanges. The method and system also allows inputting and monitoring of the spreads from one or more graphical windows on a graphical user interface. The method and system provide automatic generation of one or more legs of an automatic spread and automatic readjustment of desired market limit prices using one or more pre-determined spread trading factors and market depth information to maintain the desired price differential for the automatic spread.

Owner:ROSENTHAL COLLINS GROUP

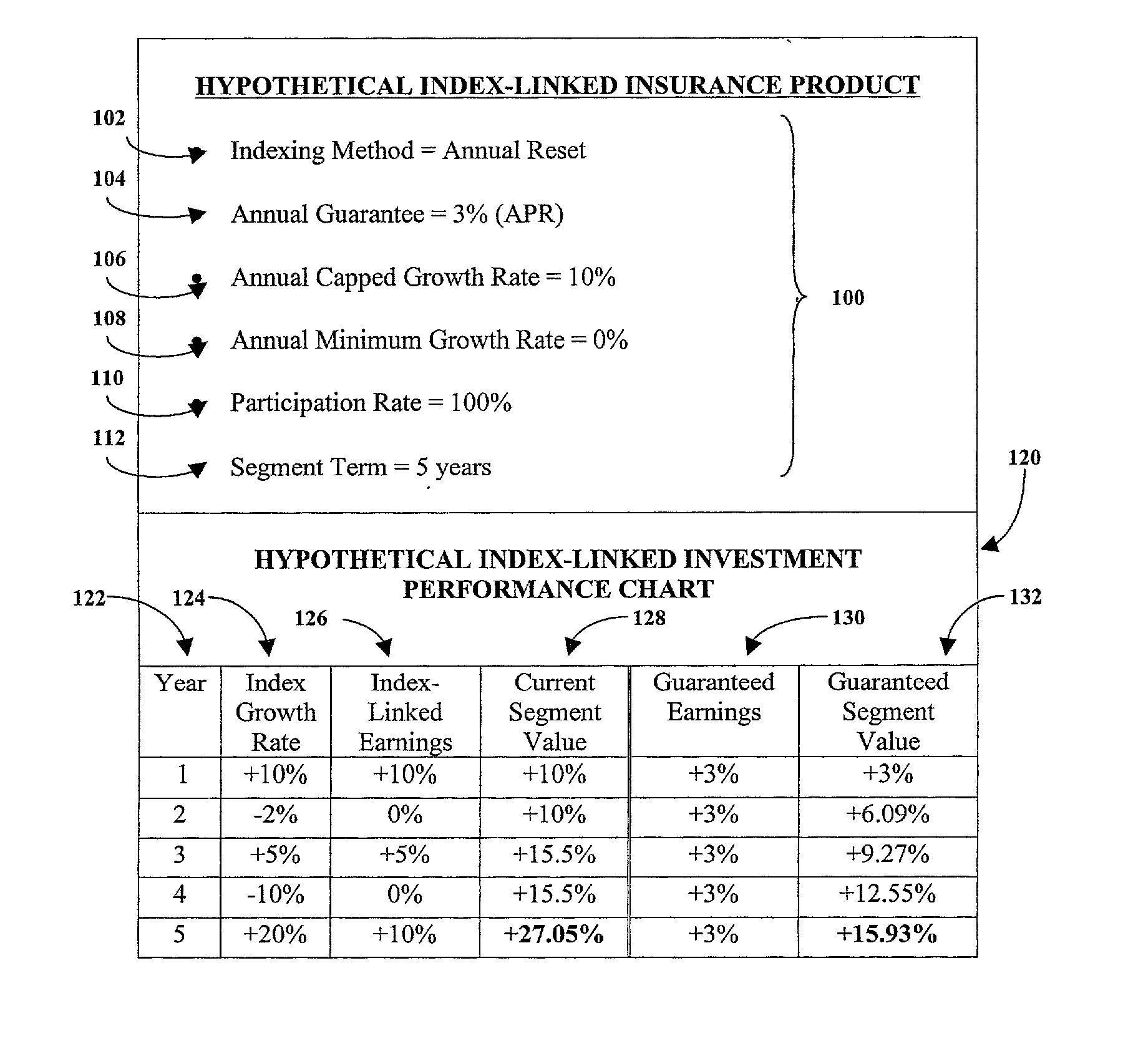

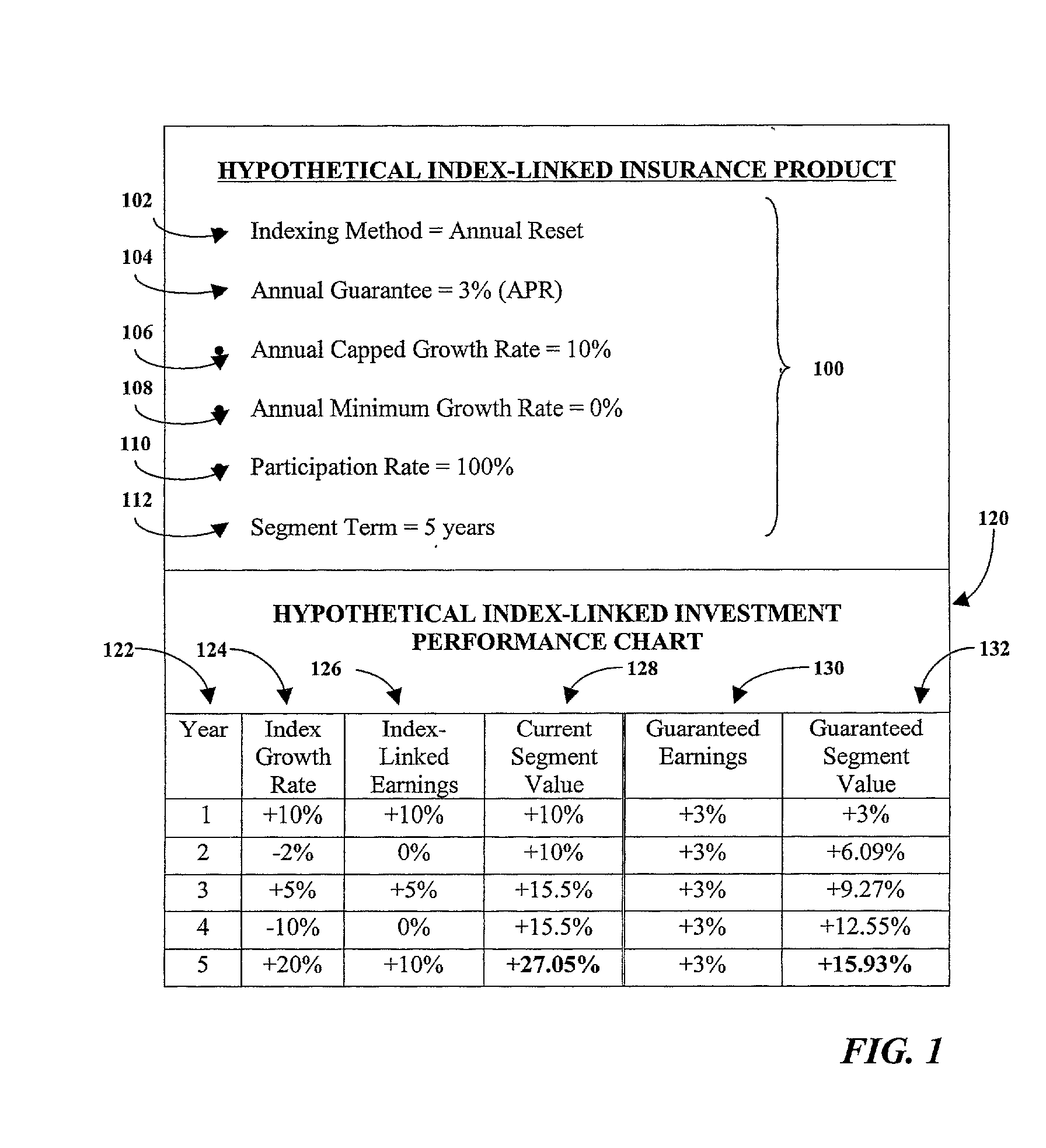

Maximization of a hedged investment budget for an index-linked insurance product

An index-linked insurance product having an annual guarantee is implemented having a maximized hedged investment budget. A net premium payment is allocated to a fixed income investment and an annual fixed income yield is projected. The maximized hedged investment budget is determined by deducting from the projected annual fixed income a product spread and an estimated cost of the annual guarantee. The deducted estimated cost of the annual guarantee is allocated to a risk fund. The maximized hedged investment budget is allocated to a hedged investment designed to generate proceeds for supporting index-linked earnings credited to the index-linked insurance product. Upon expiration of the product term, if the amount credited based on the index-linked earnings does not equal to at least the compounded annual guarantee, the amount credited is increased to be equal to the compounded annual guarantee. The increased credit may be supported using funds from the risk fund and other reserves if necessary.

Owner:ACCORDIA LIFE & ANNUITY

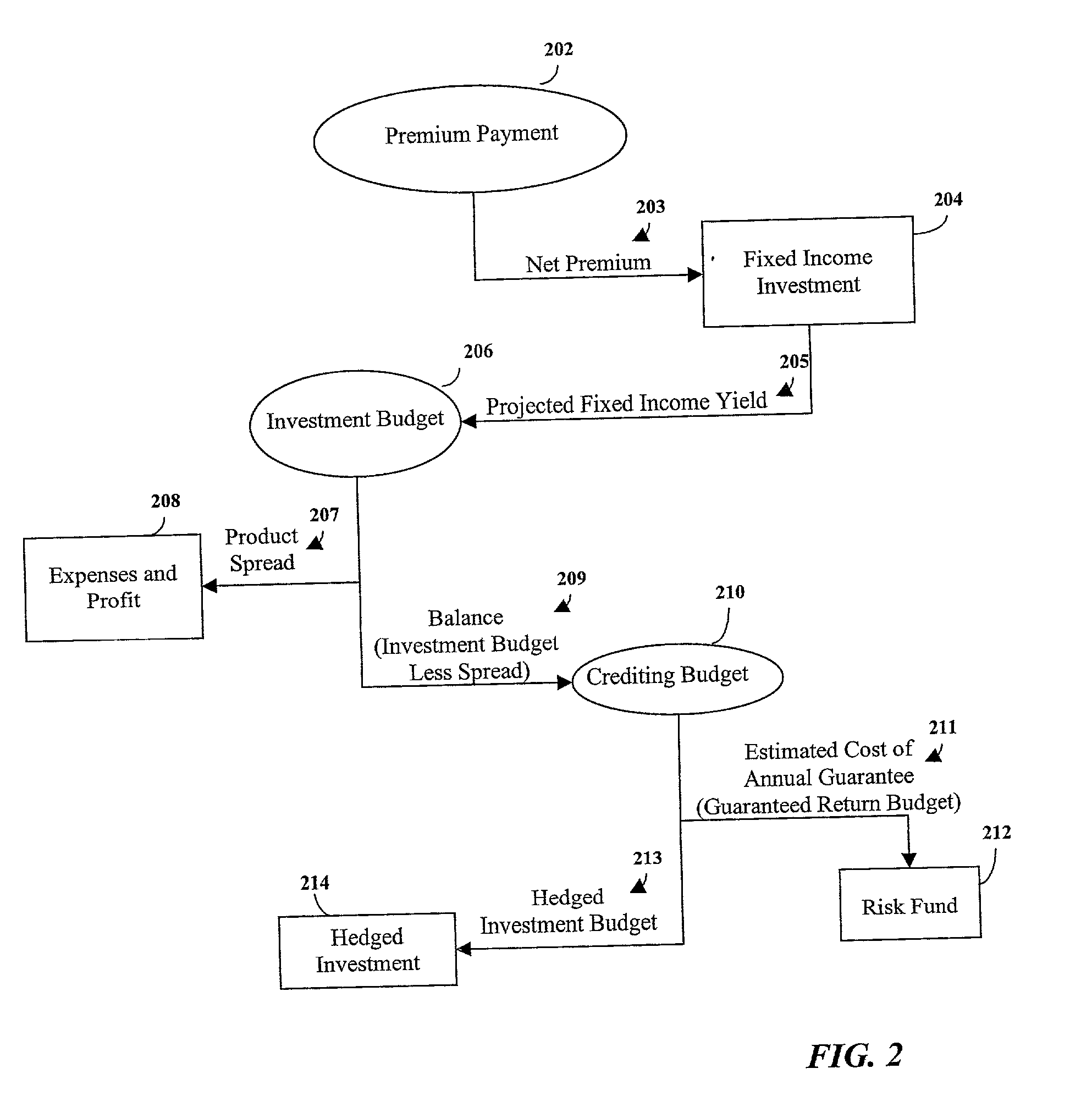

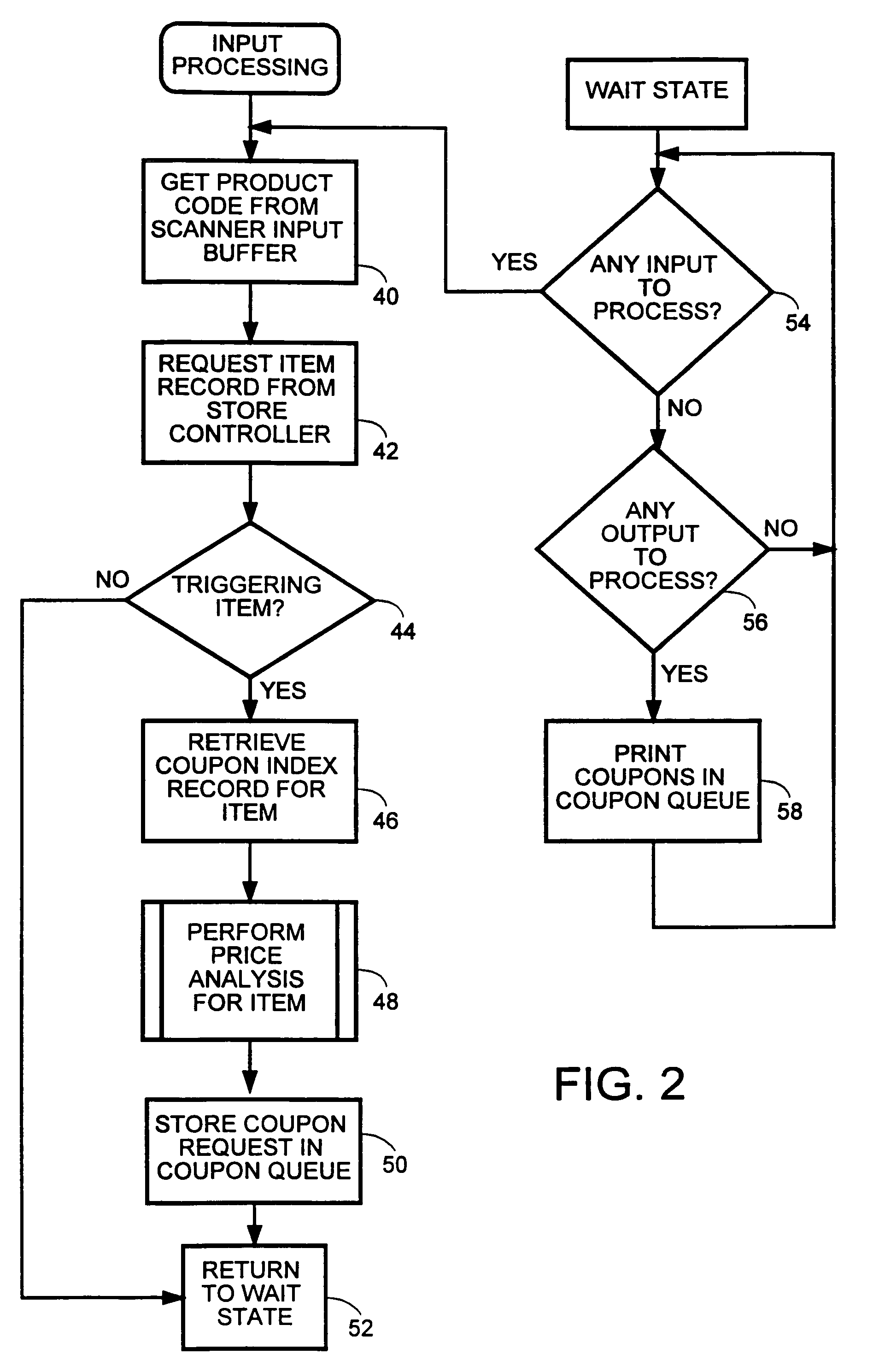

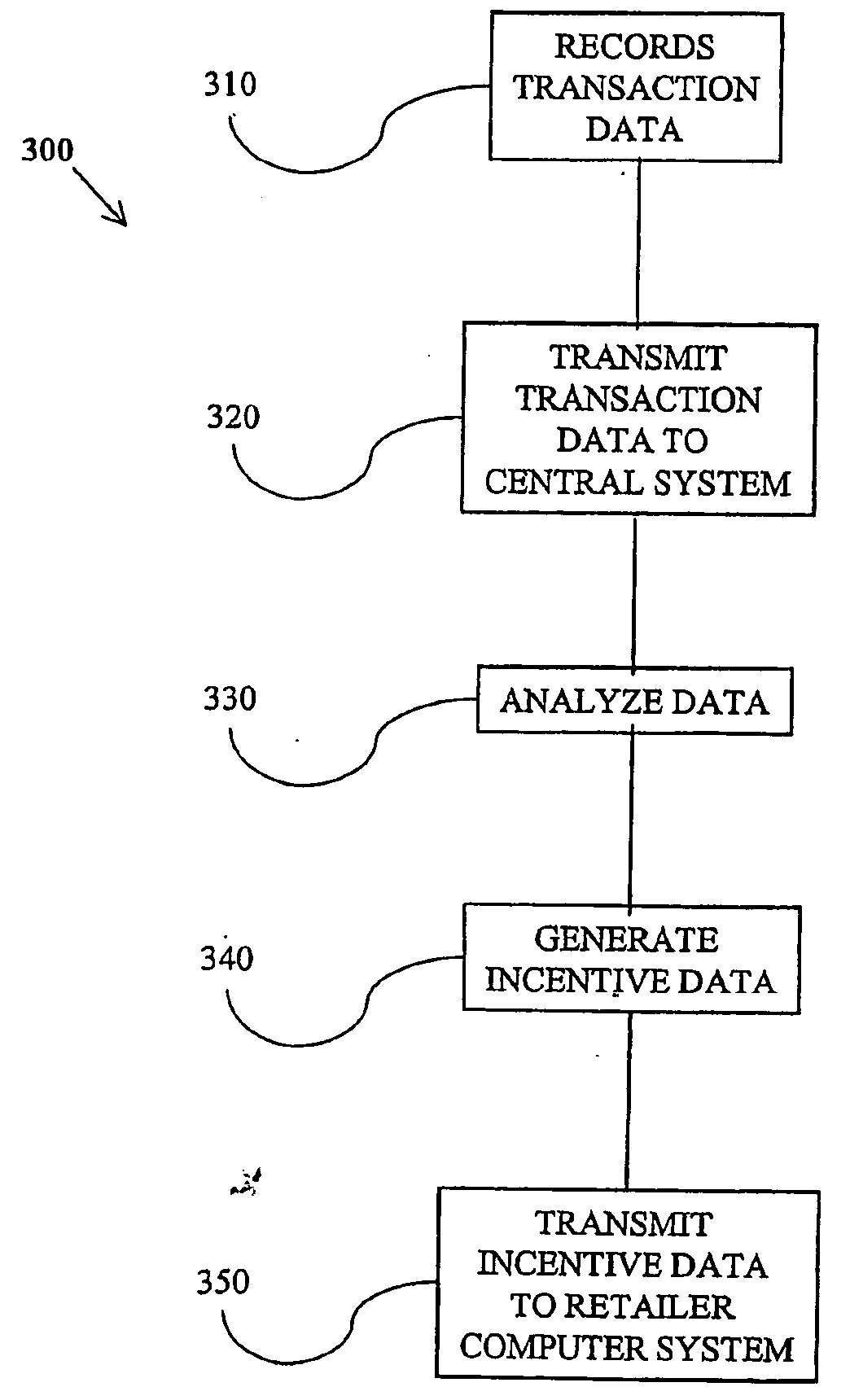

Method and apparatus for generating purchase incentives based on price differentials

A technique for customizing purchase incentives, such as discount coupons and the like, based on whether a consumer buys a promoted item or a competitive item, and on the price of the promoted item relative to the competitive item. The invention identifies promoted or competitive products in a consumer's order, and selects an incentive that is appropriate for the price differential between the promoted and competitive items, and for the purchase choice already made between the promoted and competitive items. a different incentive is provided for the different pricing and choice combinations, in an effort to maximize sales for the promoted item, and the different incentives are stored in an incentive matrix accessed by product purchased and by consumer profile as determined from whether the consumer bought the more expensive item, the less expensive item, or one of two equally priced items.

Owner:NEC ELECTRONICS CORP +1

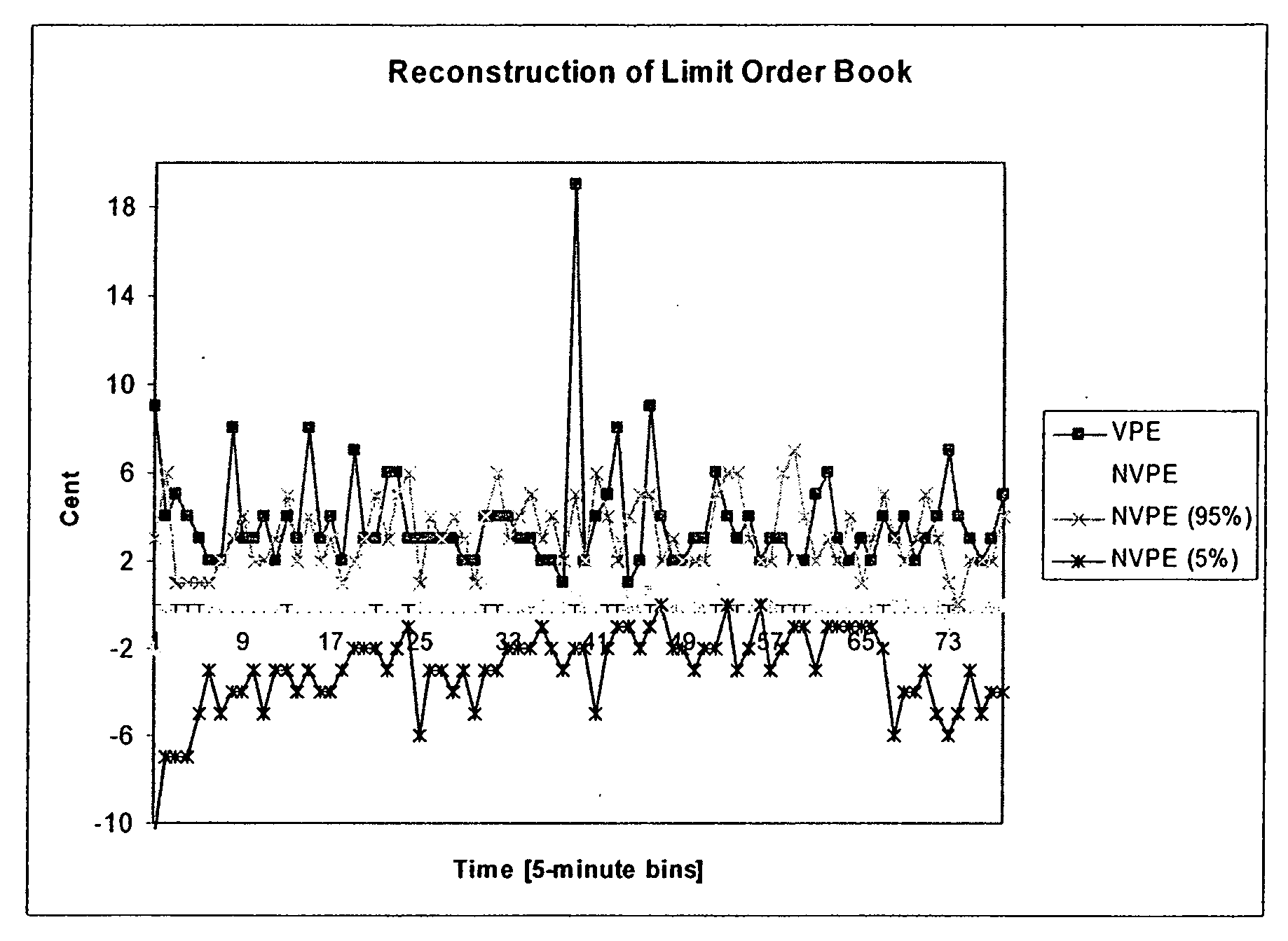

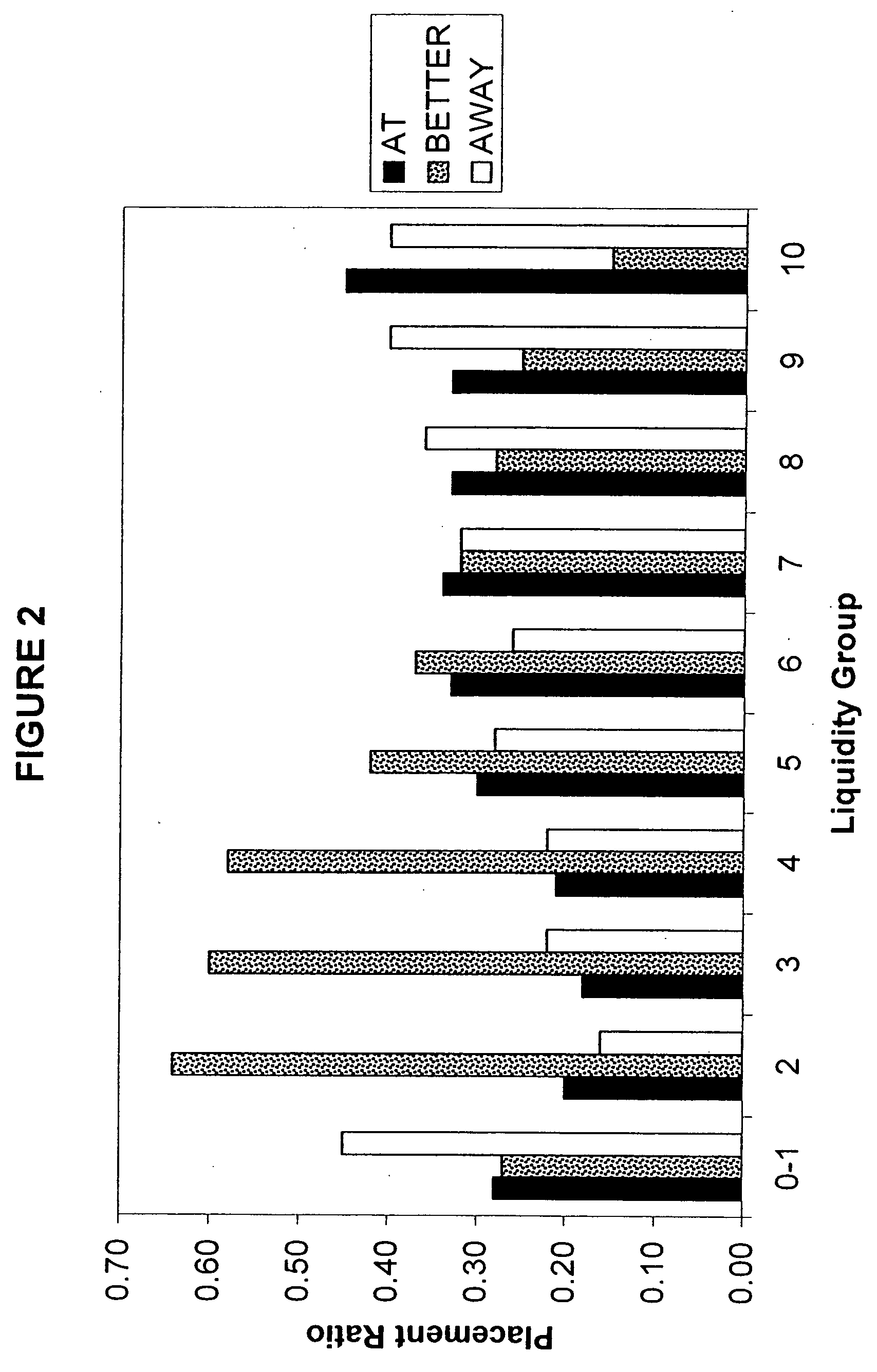

Algorithmic trading system and method

A system and method for allowing market participants to evaluate the likelihood of finding hidden volume. The model can predict hidden volume and assess the probability that a market order will be executed within the spread and better than the mid-quote. The cost per immediate execution can be assessed.

Owner:ITG SOFTWARE SOLUTIONS INC

Method and system for automatically inputting, monitoring and trading risk- controlled spreads

A method and system for providing dynamic display of electronic trading information for trading risk-controlled spreads. The method and system allow spreads to be automatically inputted, executed, monitored and managed via plural different risk controls on one or more trading exchanges. The method and system provide automatic readjustment of desired market limit prices using one or more pre-determined spread trading risk factors and market depth information to maintain a desired price differential and a desired risk level for the automatic risk-controlled spread.

Owner:ROSENTHAL COLLINS GROUP

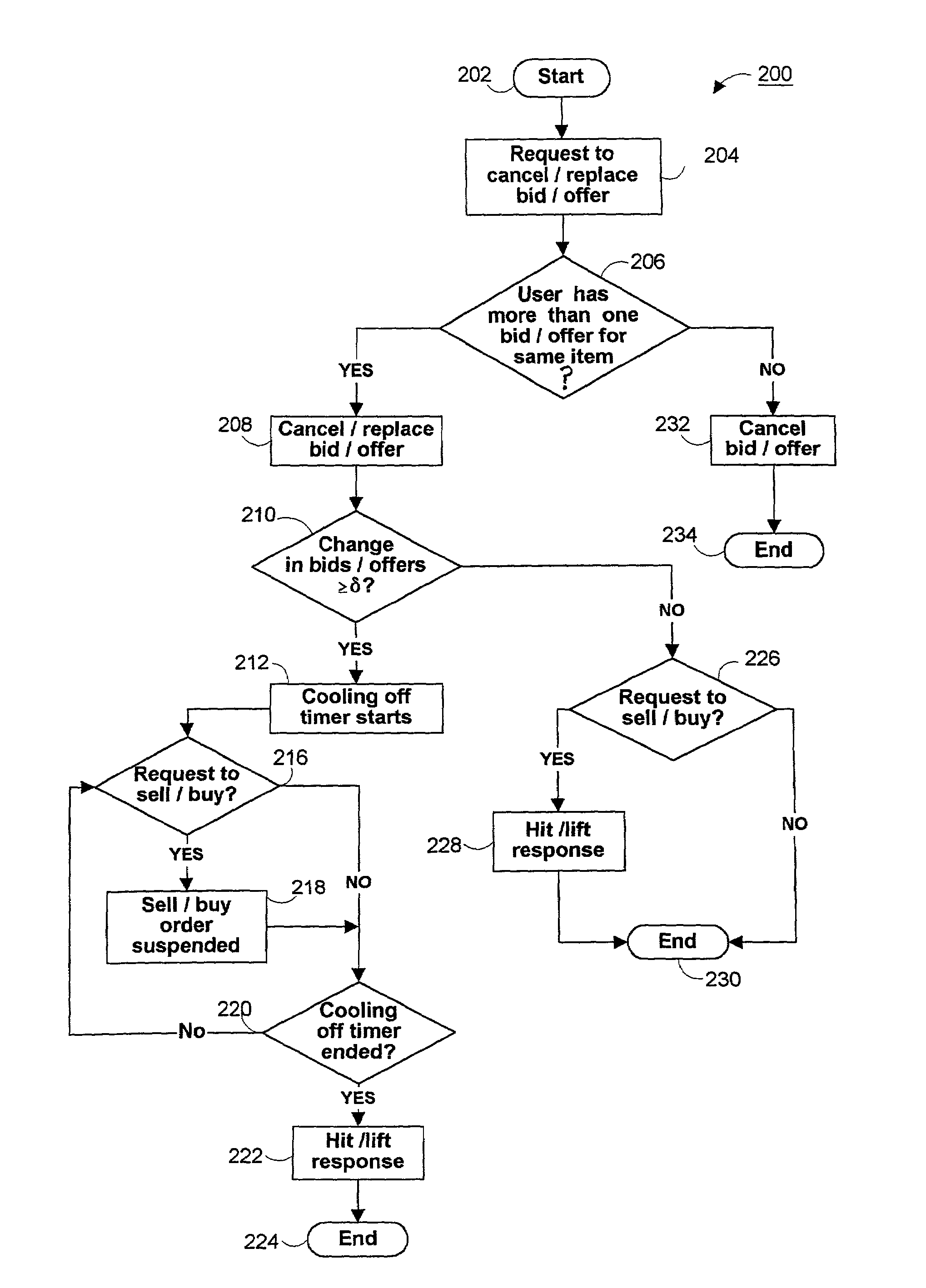

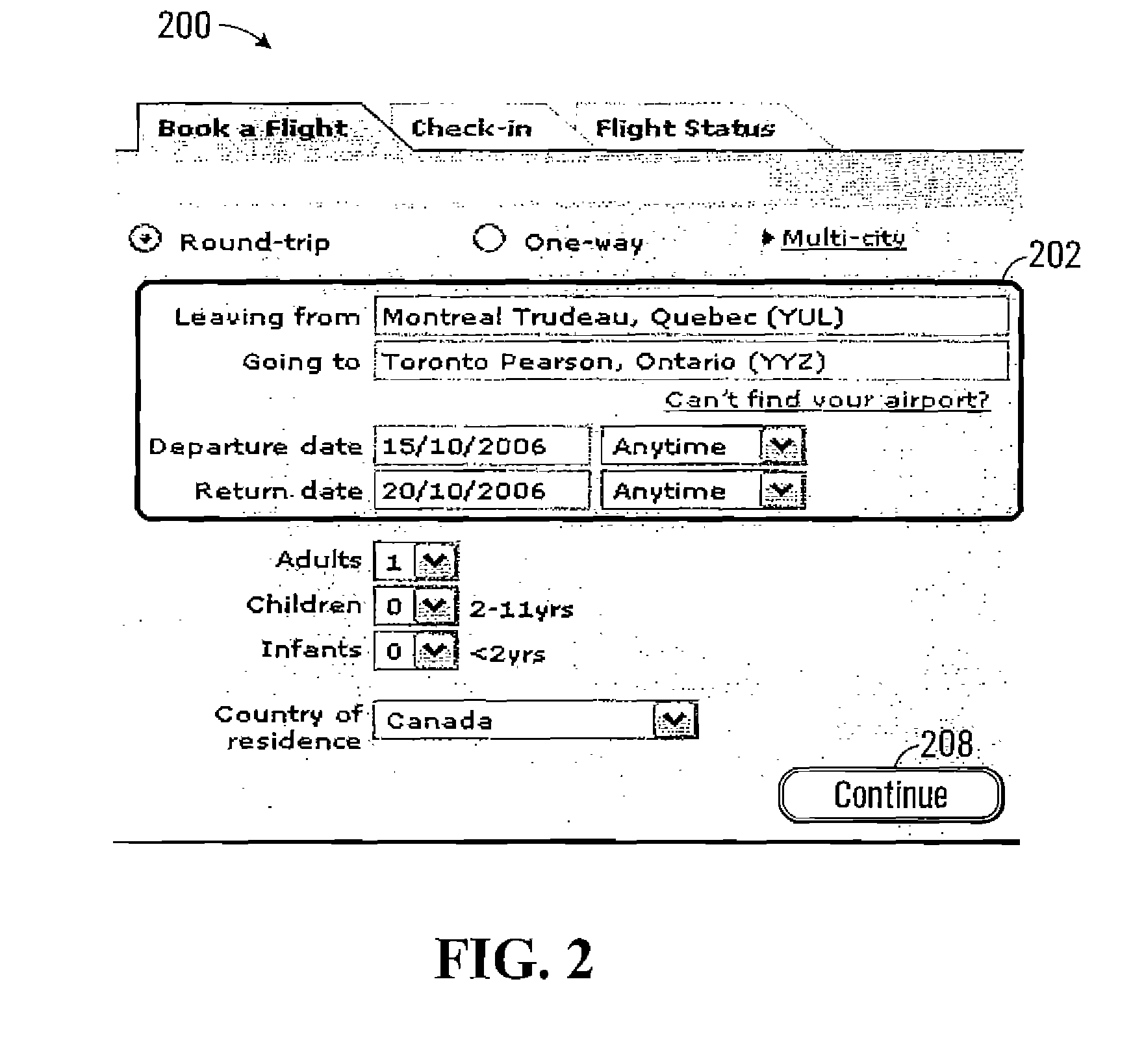

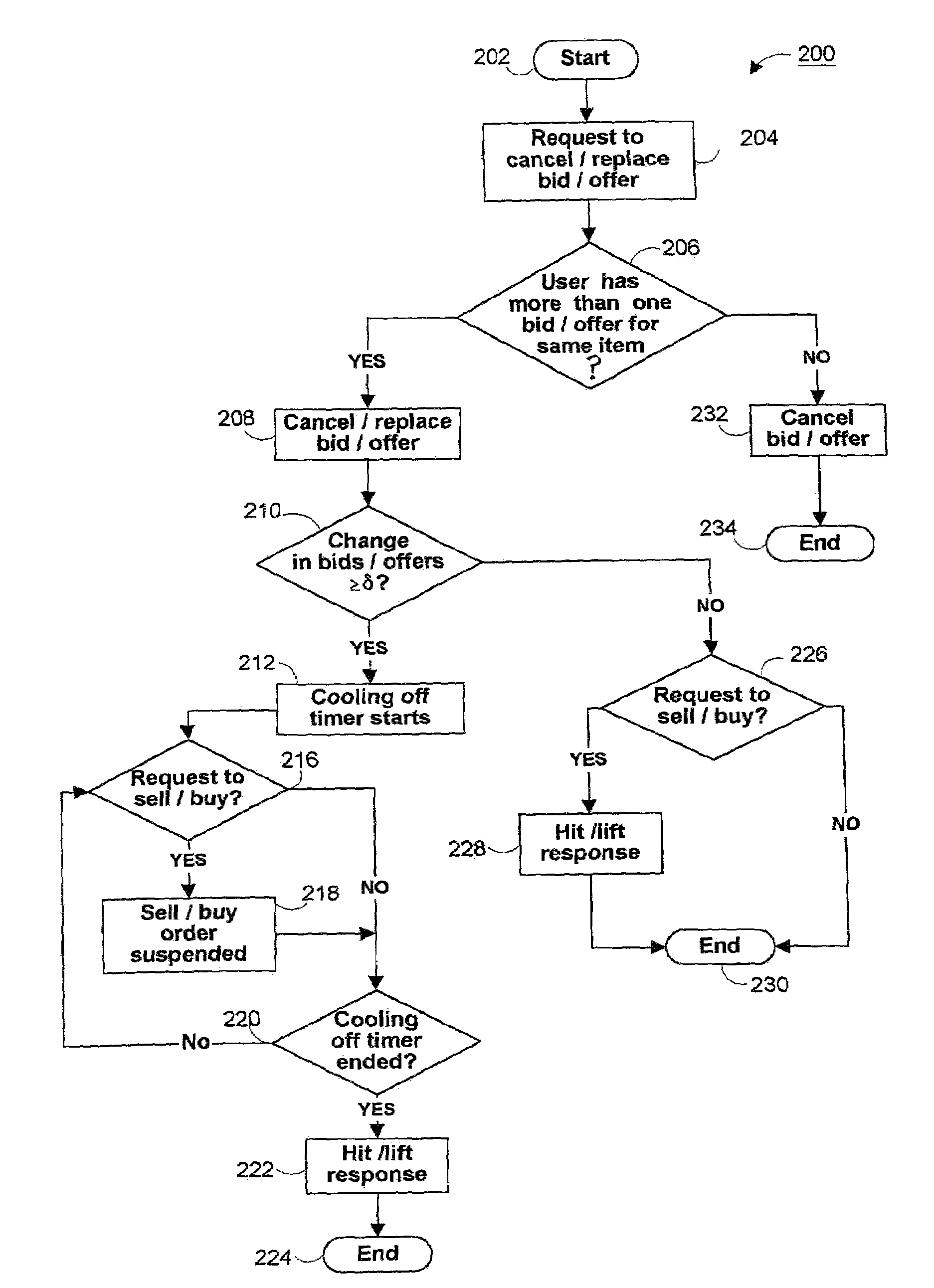

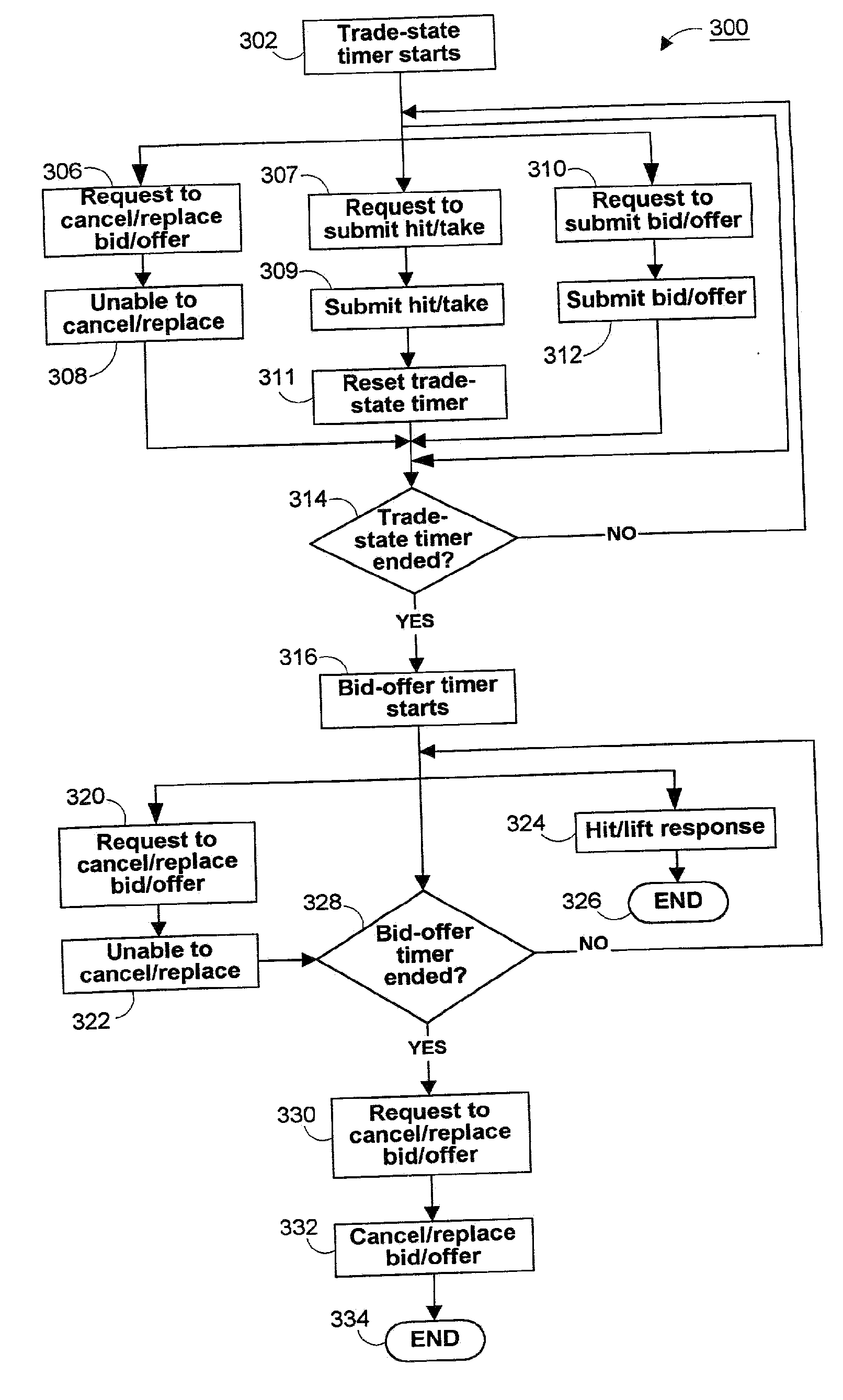

Systems and methods for controlling traders from manipulating electronic trading markets

Systems and methods are provided to control gaming in electronic trading markets. These systems and methods alleviate the problem of a seller or buyer trying to act on a trader's original bid or offer only to trade at an unfavorable level after the trader changes the bid or offer. A pricing method suspends trading for a period of time if a price difference between two bids or offers by the same trader is too great. A timing method prevents a trader from canceling or replacing a bid or offer for a period of time. These methods provide a more fair and efficient way of executing electronic trades.

Owner:BGC PARTNERS LP

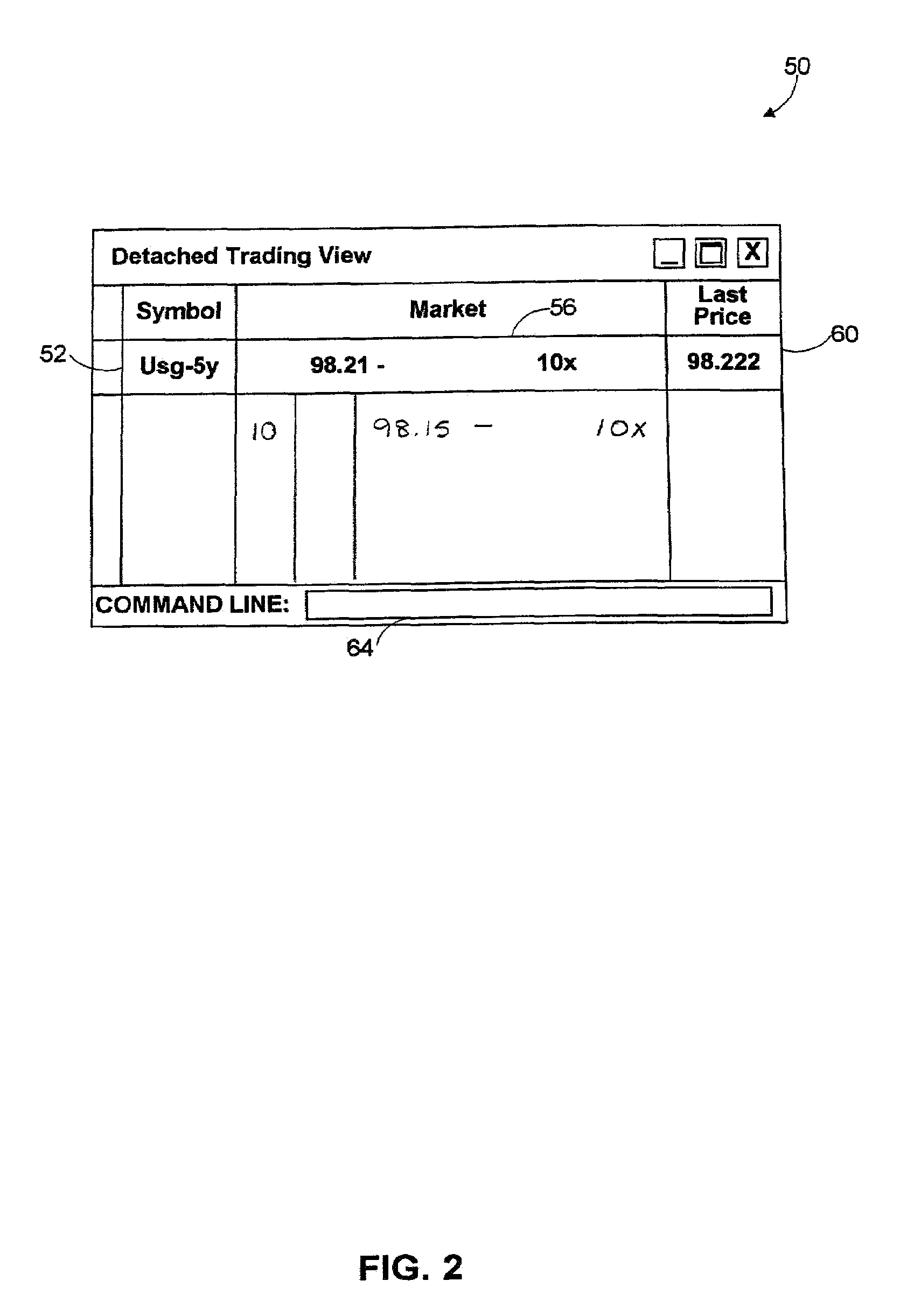

Method and system for electronically inputting, monitoring and trading spreads

A method and system for providing dynamic display of electronic trading information for trading spreads. The method and system allow pre-determined and trader defined spreads to be input and one or more trades for the spreads to be automatically executed on one or more trading exchanges. The method and system also allows monitoring of the spreads from one or more graphical windows on a graphical user interface.

Owner:ROSENTHAL COLLINS GROUP

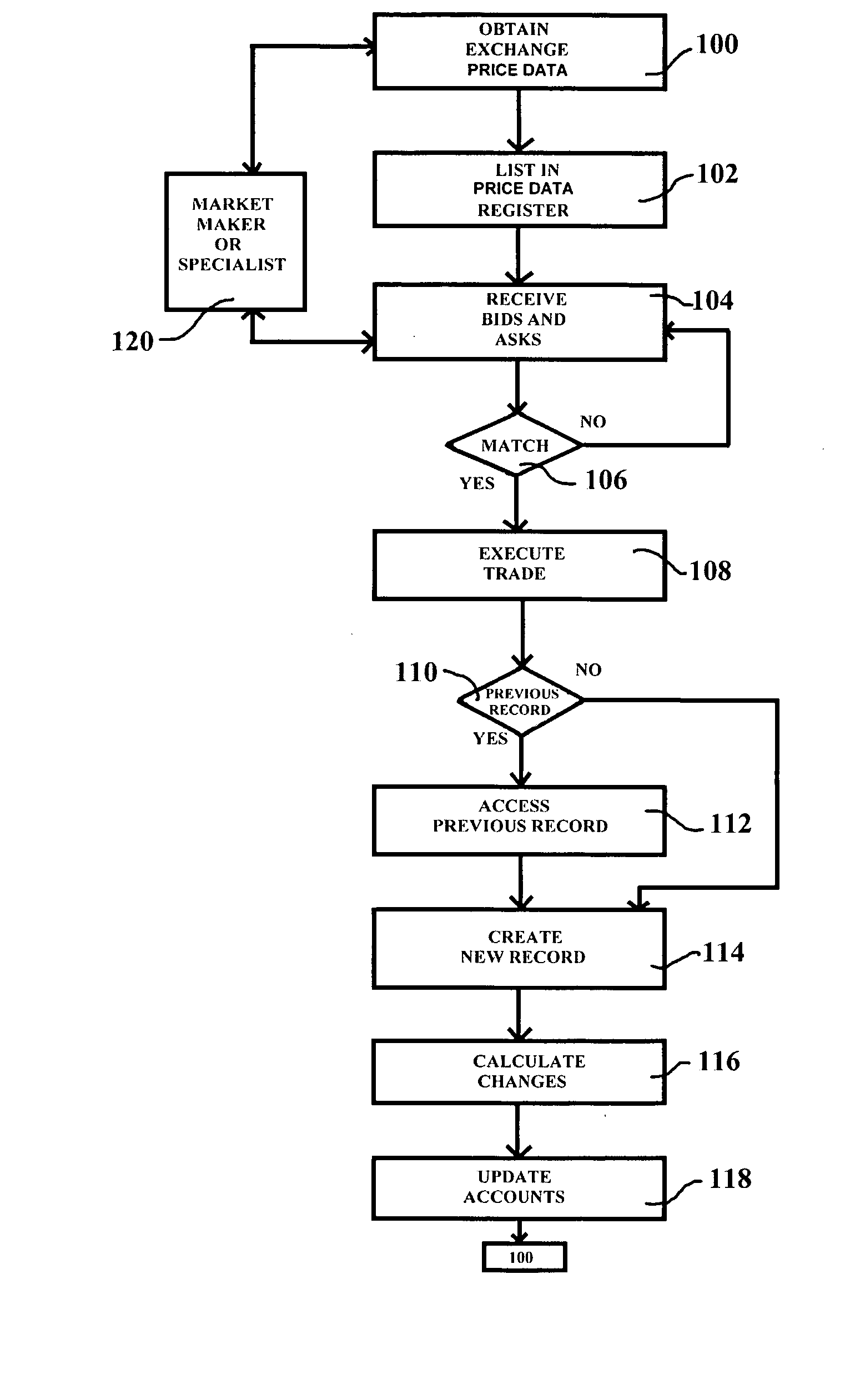

Cash only marketplace system for trading securities

A method, system and programmed medium for use by buyers and sellers in the trading of a security. All transactions will involve only cash. The system provides an electronic marketplace in which only customers are involved in any trade. Brokers, specialists, market makers, and stock transfer agents are not required. In this electronic marketplace system, customers have a direct connection to the securities market. Shares representative of underlying securities are traded, and ownership of the underlying security is not taken. In each transaction, a transaction number is generated to code price, volume, date, owner and other information, and a processor uses the transaction record to reconcile accounts in an accounts database. Due to efficiency of the system, transaction costs in this system may be set near or at zero, depending on the commission fee set by the system. If desired, the spread between bid and asked prices may be eliminated.

Owner:GARCIA CRISOSTOMO B

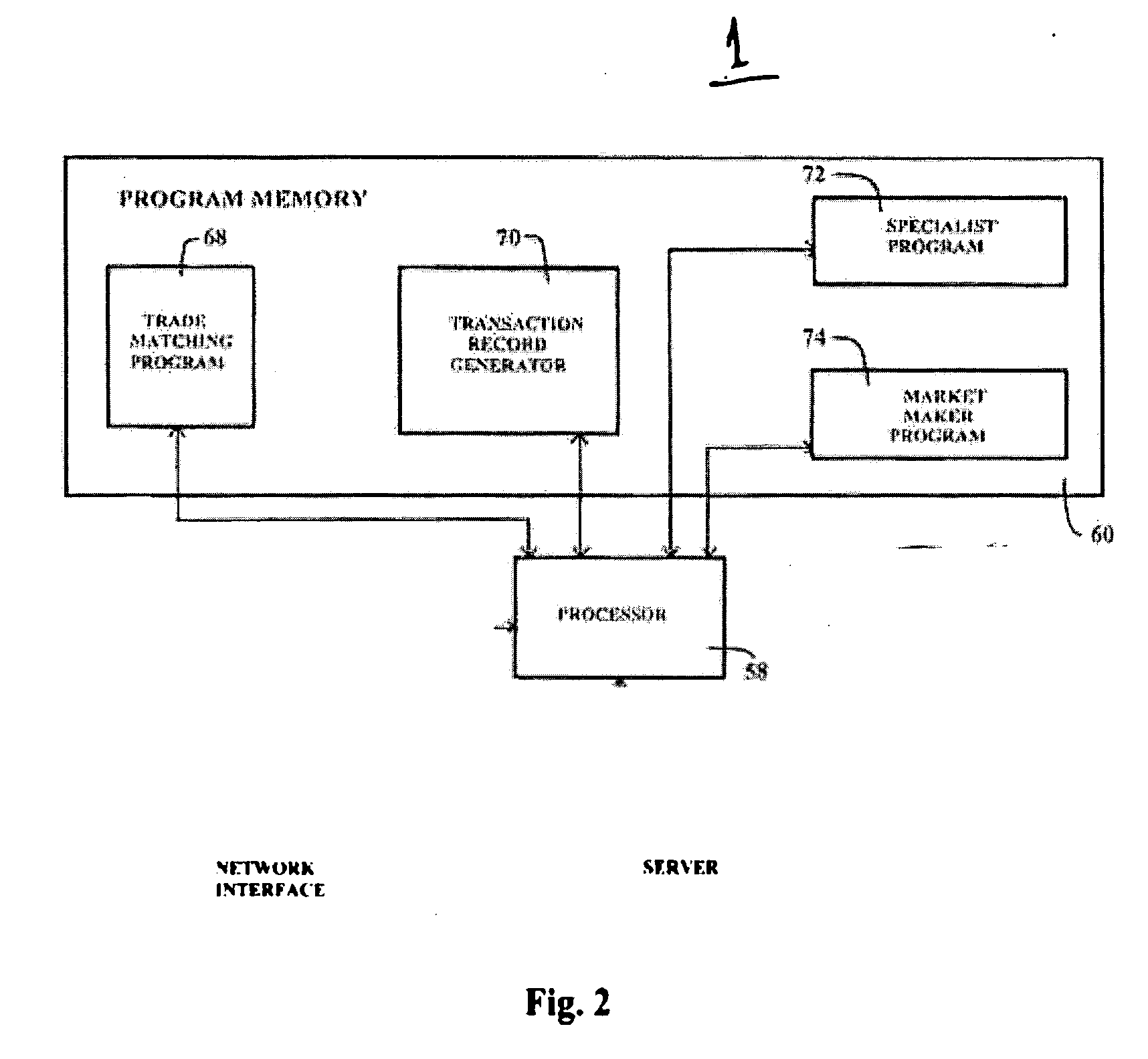

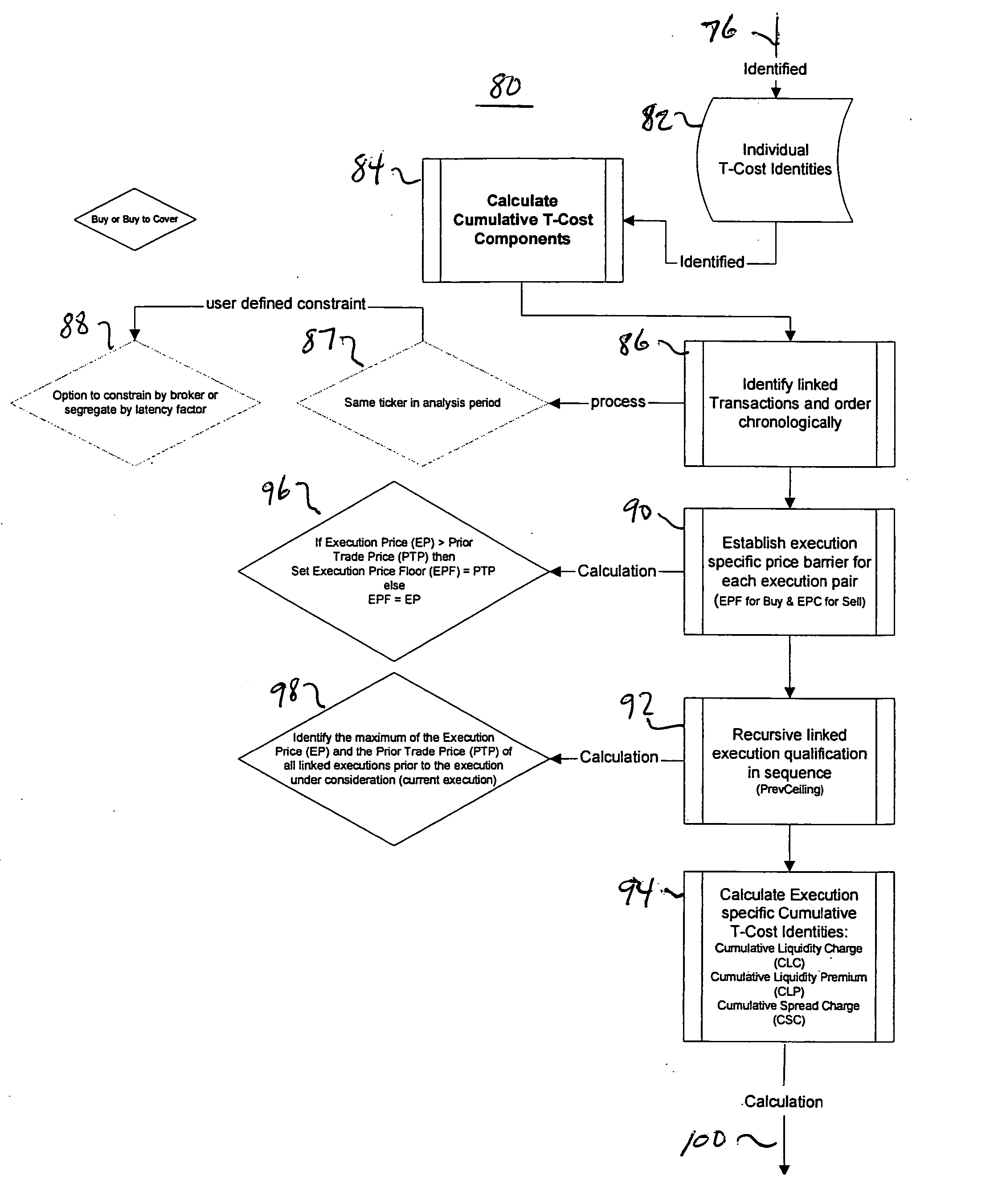

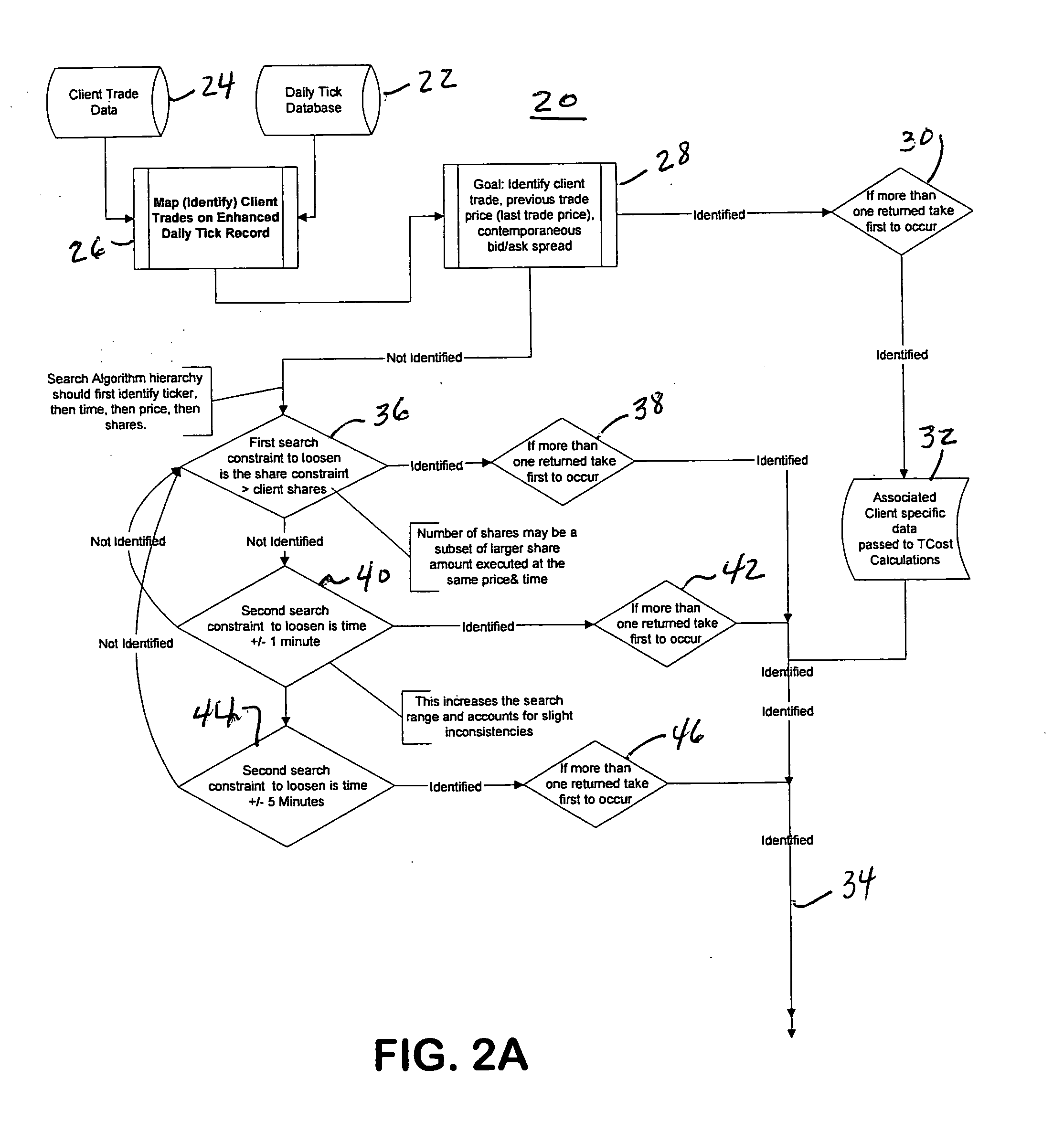

Data processing system, methods and computer program for determining the transaction costs for a linked set of stock transactions

InactiveUS20050102218A1Quick identificationFinanceSpecial data processing applicationsData processing systemFinancial transaction

A data processing system, methods and computer program that determine transaction costs associated with a stock trade. A first portion of the analysis is a trade identification and association portion that identifies previous related trades from a database and orders the trades by ticker identity, time, price and share volume. A second portion determines individual transaction costs, including individual liquidity charge, individual liquidity premium and individual spread charge. A third portion determines cumulative liquidity charge, cumulative liquidity premium and cumulative spread charge. The program that enables the various analyses is also disclosed.

Owner:QUANTITATIVE SERVICES GROUP

Methods and systems for vending air travel services

A computer-implemented method of vending air travel services comprises determining a plurality of published fares each associated with a respective one of a plurality of root booking classes, said published fares being applicable to the purchase of air travel at a root service level. The method further comprises determining a plurality of derived fares each associated with a respective equivalent booking class that is one of the root booking classes, said derived fares being applicable to the purchase of air travel at a non-root service level, the derived fare for which the equivalent booking class is a particular one of the root booking classes being computed from the published fare associated with the particular one of the root booking classes by applying a price differential that is common across multiple ones of the root booking classes. The method further comprises offering the sale of air travel at a plurality of price points that includes at least a first one of the published fares and at least a first one of the derived fares, wherein the equivalent booking class associated with said first one of the derived fares corresponds to the root booking class associated with said first one of the published fares.

Owner:AIR CANADA

Systems and methods for controlling traders from manipulating electronic trading markets

Systems and methods are provided to control gaming in electronic trading markets. These systems and methods alleviate the problem of a seller or buyer trying to act on a trader's original bid or offer only to trade at an unfavorable level after the trader changes the bid or offer. A pricing method suspends trading for a period of time if a price difference between two bids or offers by the same trader is too great. A timing method prevents a trader from canceling or replacing a bid or offer for a period of time. These methods provide a more fair and efficient way of executing electronic trades.

Owner:BGC PARTNERS LP

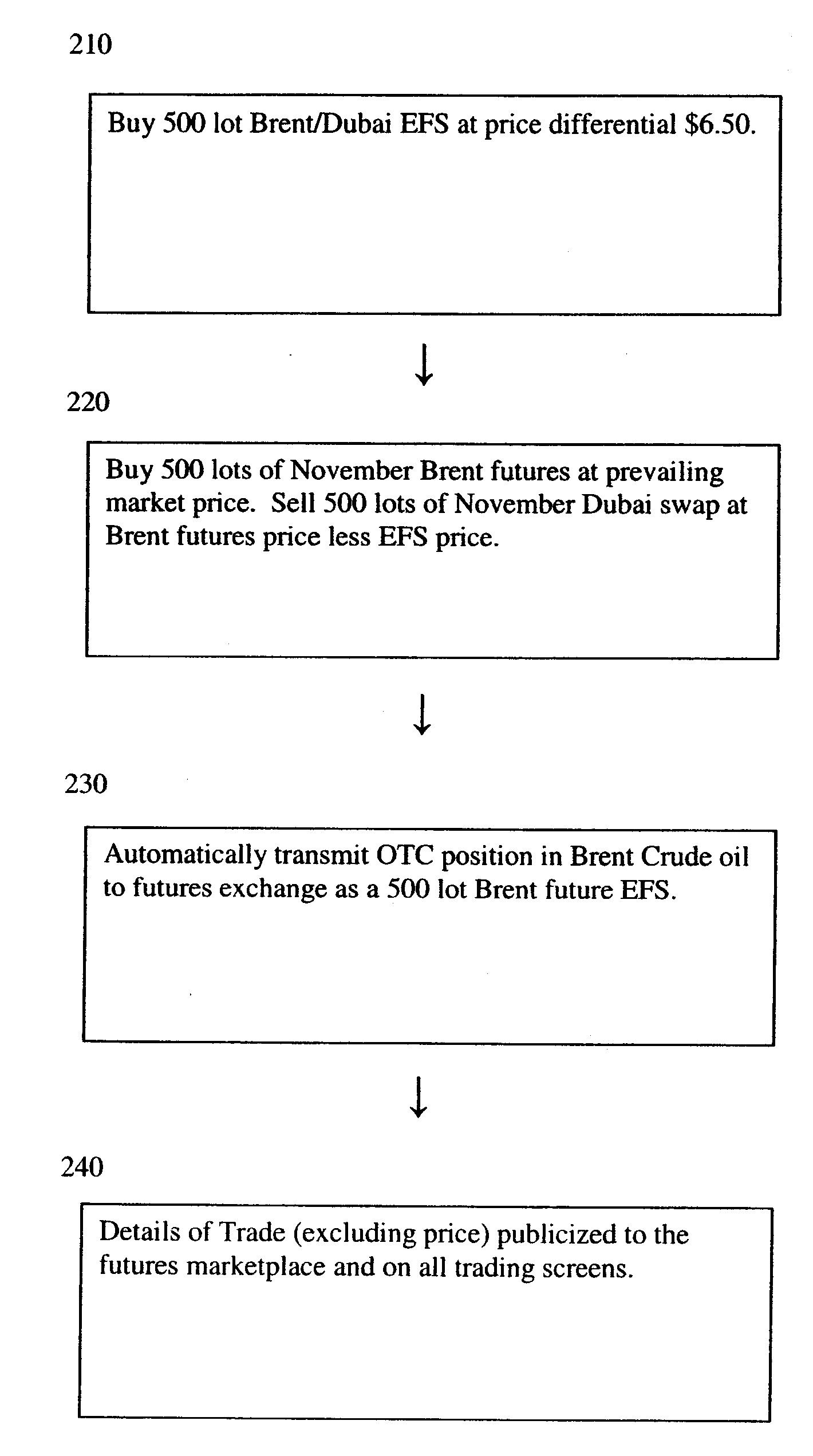

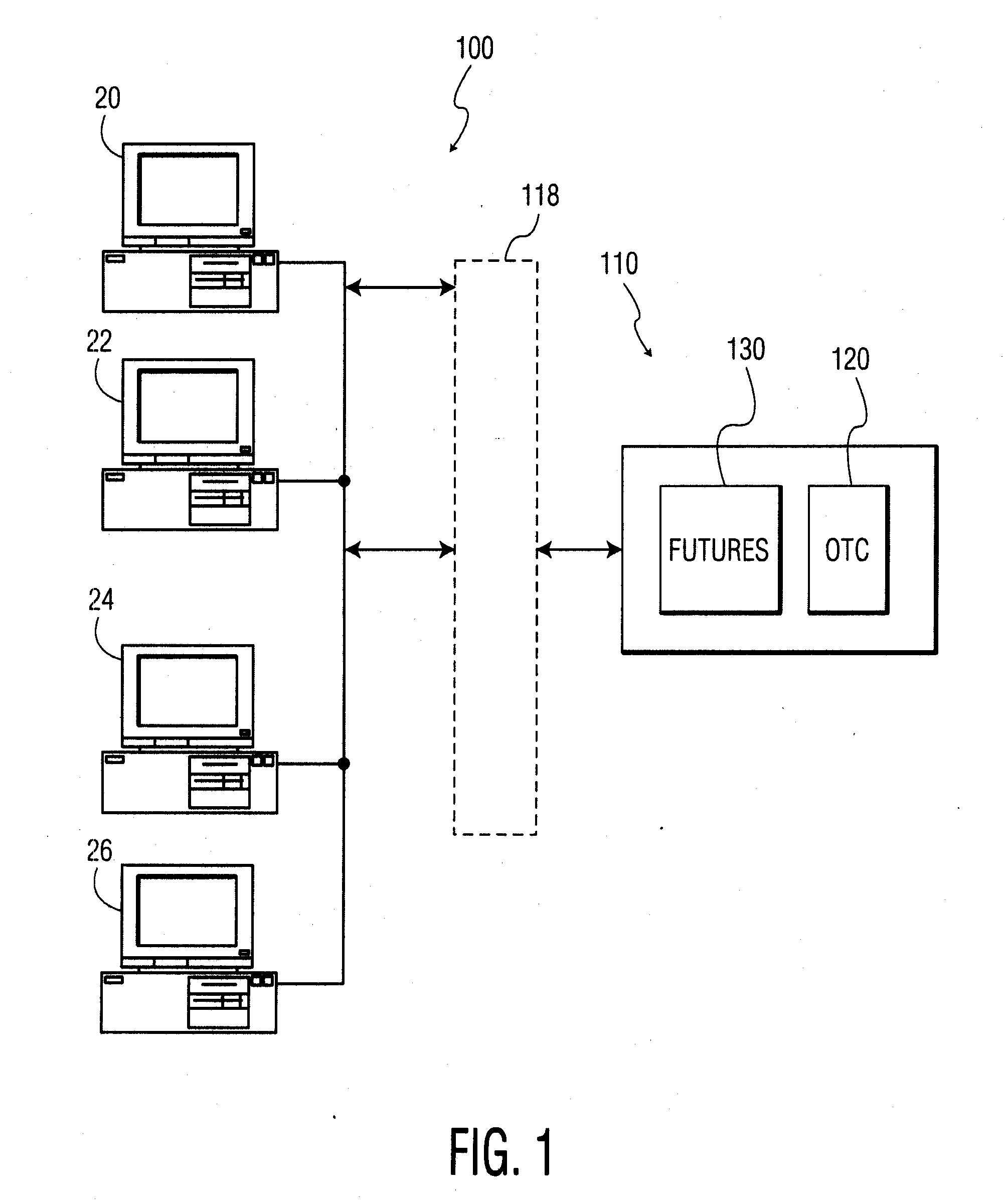

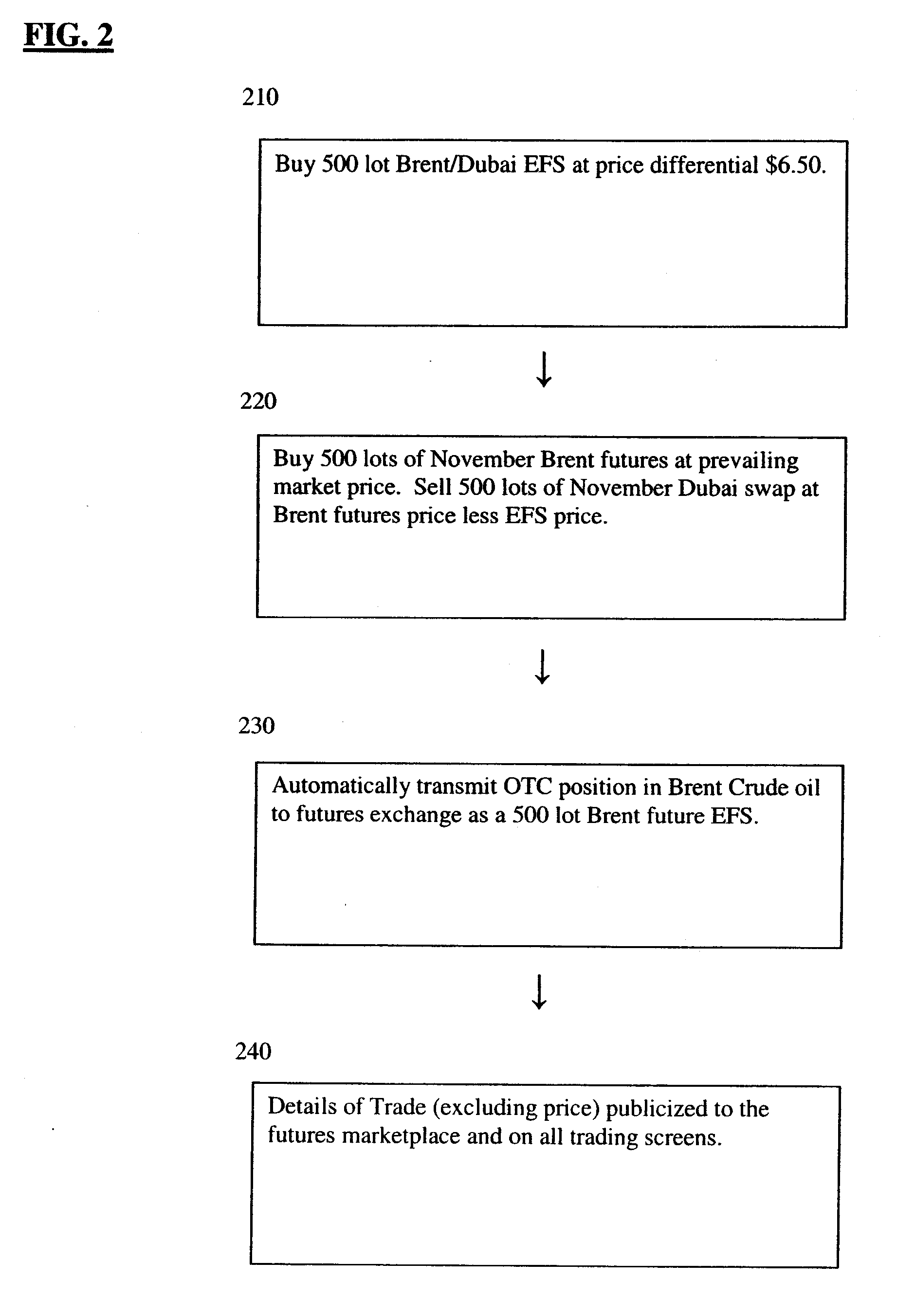

Over the counter traded product and system for offset and contingent trading of commodity contracts

A method for facilitating the offset or contingent trading of commodity contracts comprising: providing a futures exchange wherein a futures or option contract based on a first commodity of a commodity type is traded; and automatically registering a trade of the futures or options contract on the futures exchange at a market price for the futures or options contract when an over the counter contract for a second commodity of the commodity type is traded. In certain embodiments, the invention is an over the counter product comprising: a first leg comprising a purchase or sale of a futures contract based on a first commodity; and a second leg comprising a sale or purchase of an over the counter contract based on a second commodity; wherein the first commodity and the second commodity are of the same commodity type and the over the counter traded product trades at a price differential between the two legs; and wherein the purchase or sale of the futures or options contract is automatically registered on a futures exchange when the sale or purchase of the over the counter contract occurs. A system for offset or contingent trading of commodity contracts is also disclosed.

Owner:INTERCONTINENTAL EXCHANGE HLDG

Systems and methods for controlling traders from manipulating electronic trading markets

Systems and methods are provided to control gaming in electronic trading markets. These systems and methods alleviate the problem of a seller or buyer trying to act on a trader's original bid or offer only to trade at an unfavorable level after the trader changes the bid or offer. A pricing method suspends trading for a period of time if a price difference between two bids or offers by the same trader is too great. A timing method prevents a trader from canceling or replacing a bid or offer for a period of time. These methods provide a more fair and efficient way of executing electronic trades.

Owner:BGC PARTENRS INC

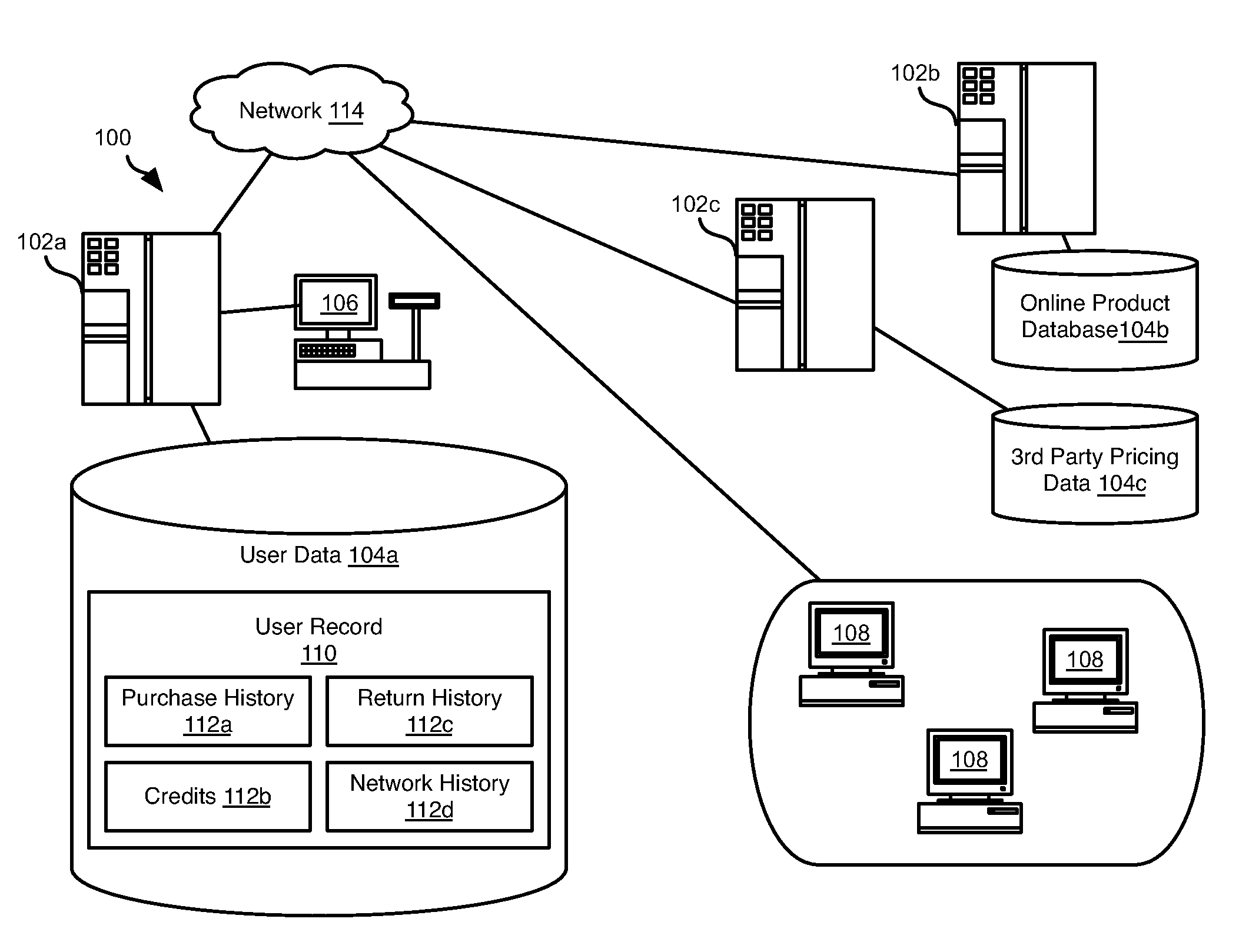

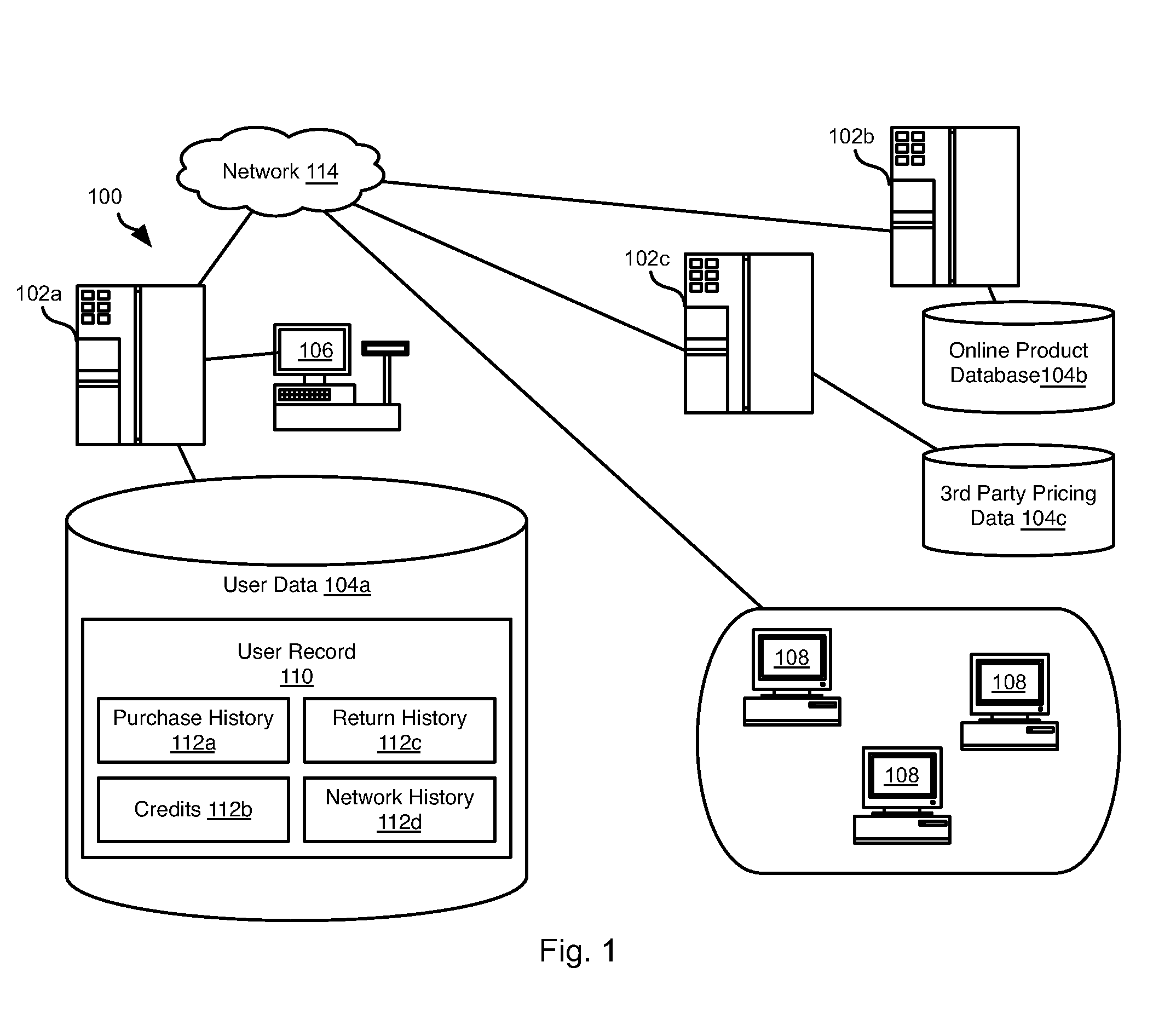

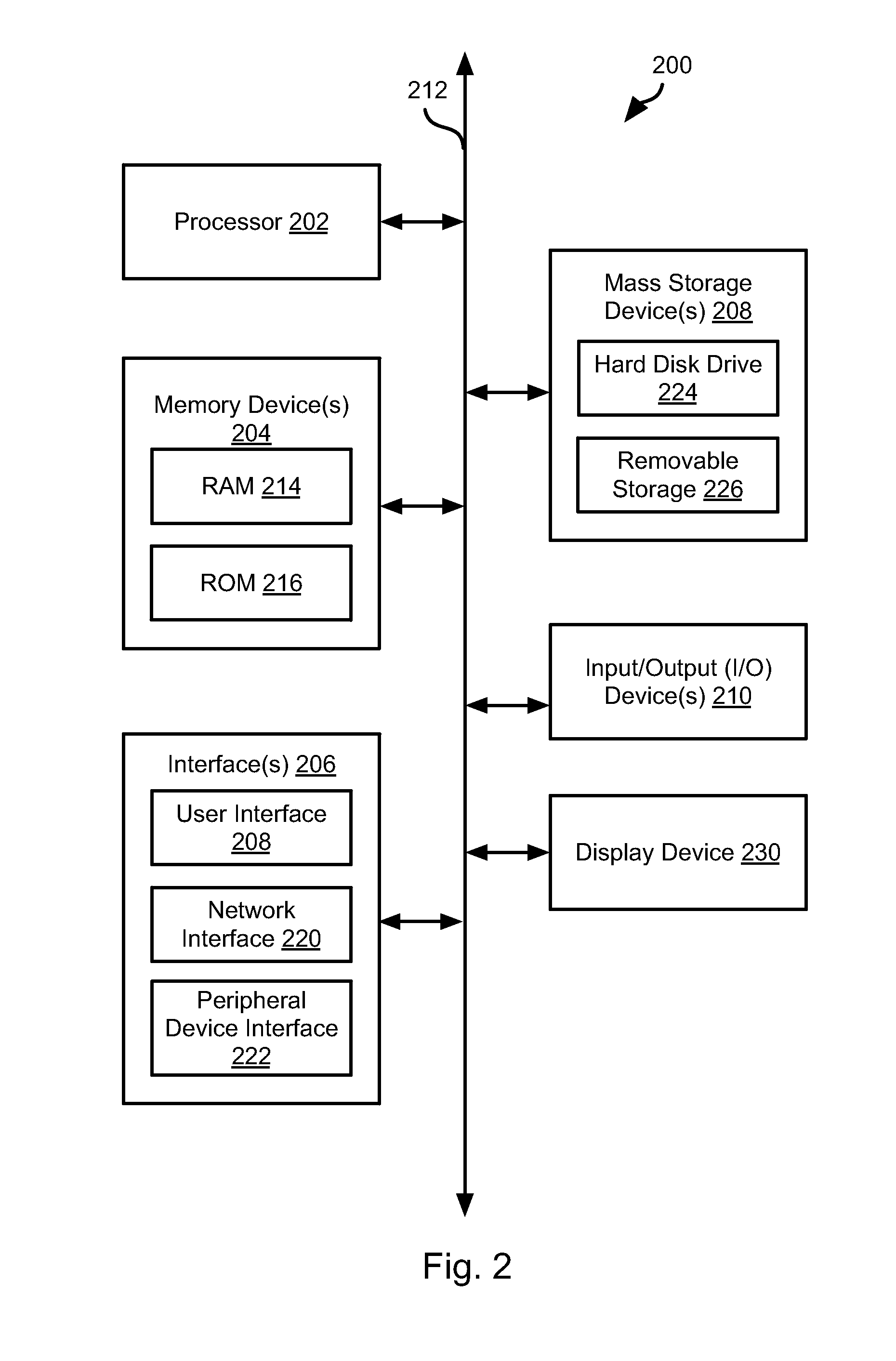

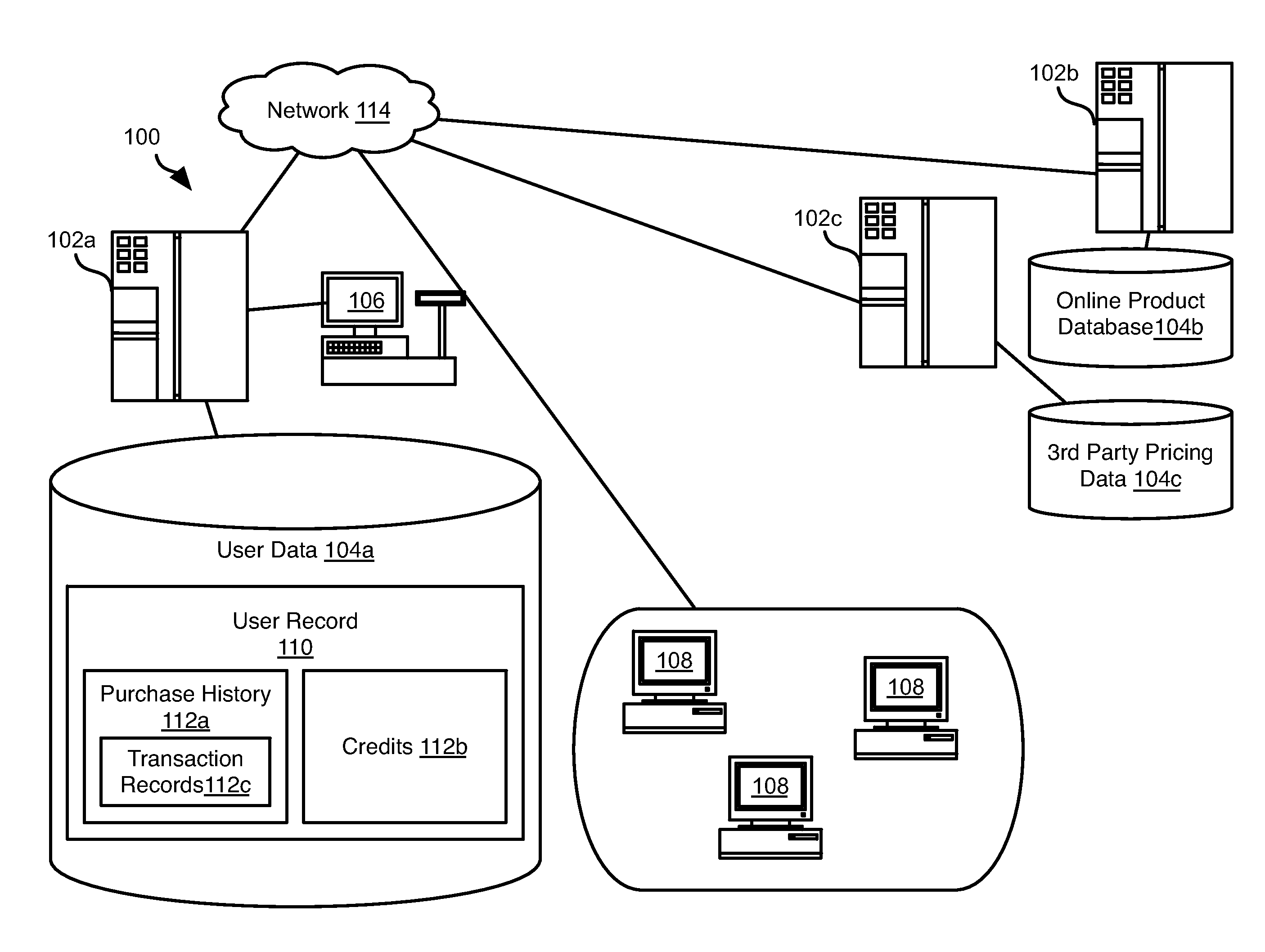

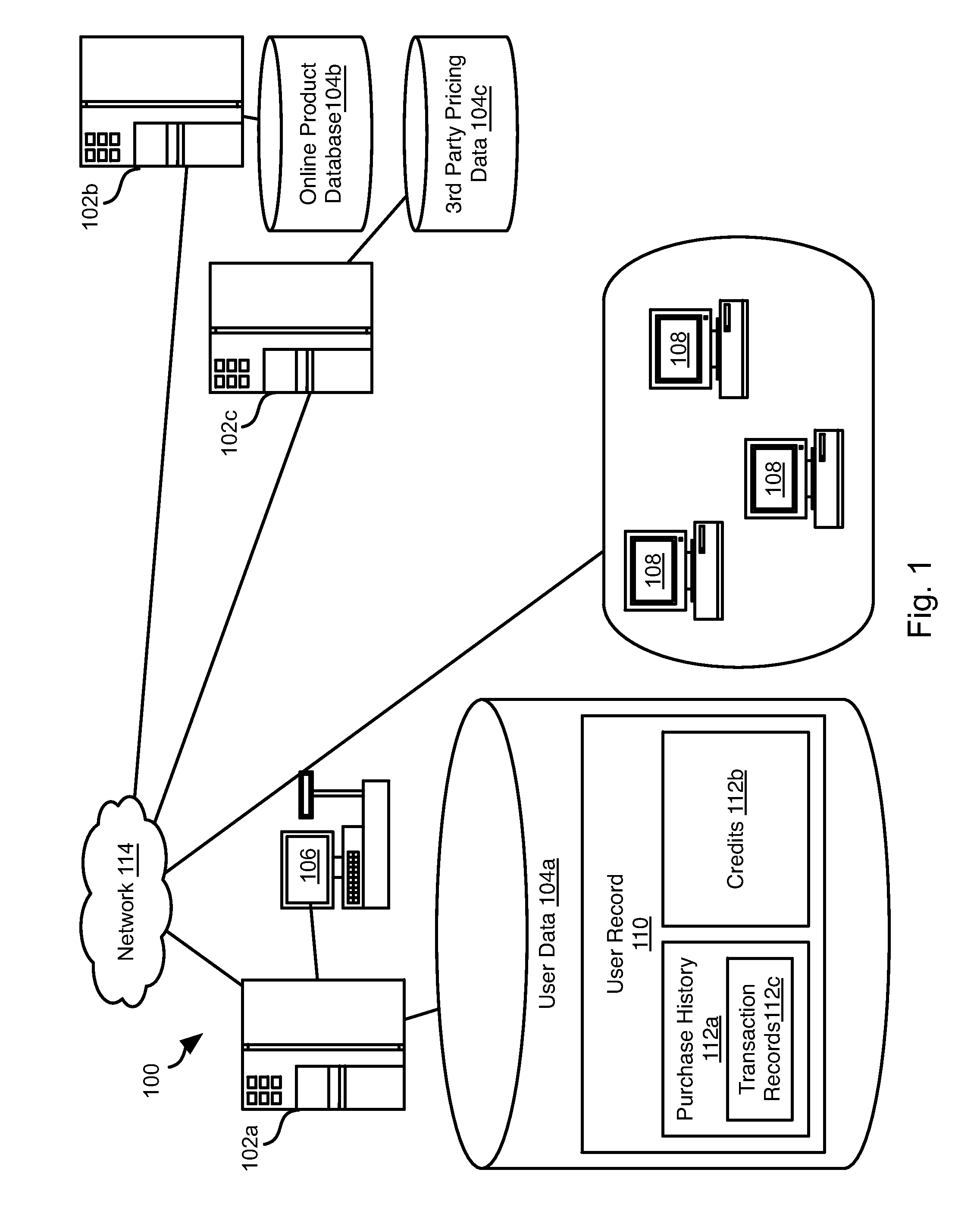

Fraud Prevention Systems And Methods For A Price Comparison System

Systems and methods are disclosed for evaluating a transaction concluded at a POS (point of sale) device. Prices for competitive retail stores within a geographic region of the POS may be evaluated after concluding a transaction. Price differences between items and corresponding prices in the third party data are identified. Where the purchase price exceeds the corresponding third-party price, a credit is assigned to the customer, such as in the form of a gift card or code that may be redeemed in a subsequent transaction. Credits may also be assigned to a debit card associated with a user, either with or without applying some multiplier. Transactions may be compared to past transaction of a user in order to detect fraud. Recent activity may be flagged as potentially fraudulent and reviewed before providing a credit.

Owner:WALMART APOLLO LLC

Price Comparison Systems and Methods

Systems and methods are disclosed for evaluating a transaction concluded at a POS (point of sale) device. Prices for competitive retail stores within a geographic region of the POS may be evaluated after concluding a transaction. Price differences between items and corresponding prices in the third party data are identified. Where the purchase price exceeds the corresponding third-party price, a credit is assigned to the customer, such as in the form of a gift card or code that may be redeemed in a subsequent transaction. Credits may also be assigned to a debit card associated with a user, either with or without applying some multiplier. A credit may be applied to an online transaction of the user. Based on the use of the credit, the user's in-store purchases and online purchases may be related to the same individual and used to better characterize interests of the user.

Owner:WALMART APOLLO LLC

System and method to create markets and trade intercommodity spreads

Owner:BOARD OF TRADE OF THE CITY OF CHICAGO

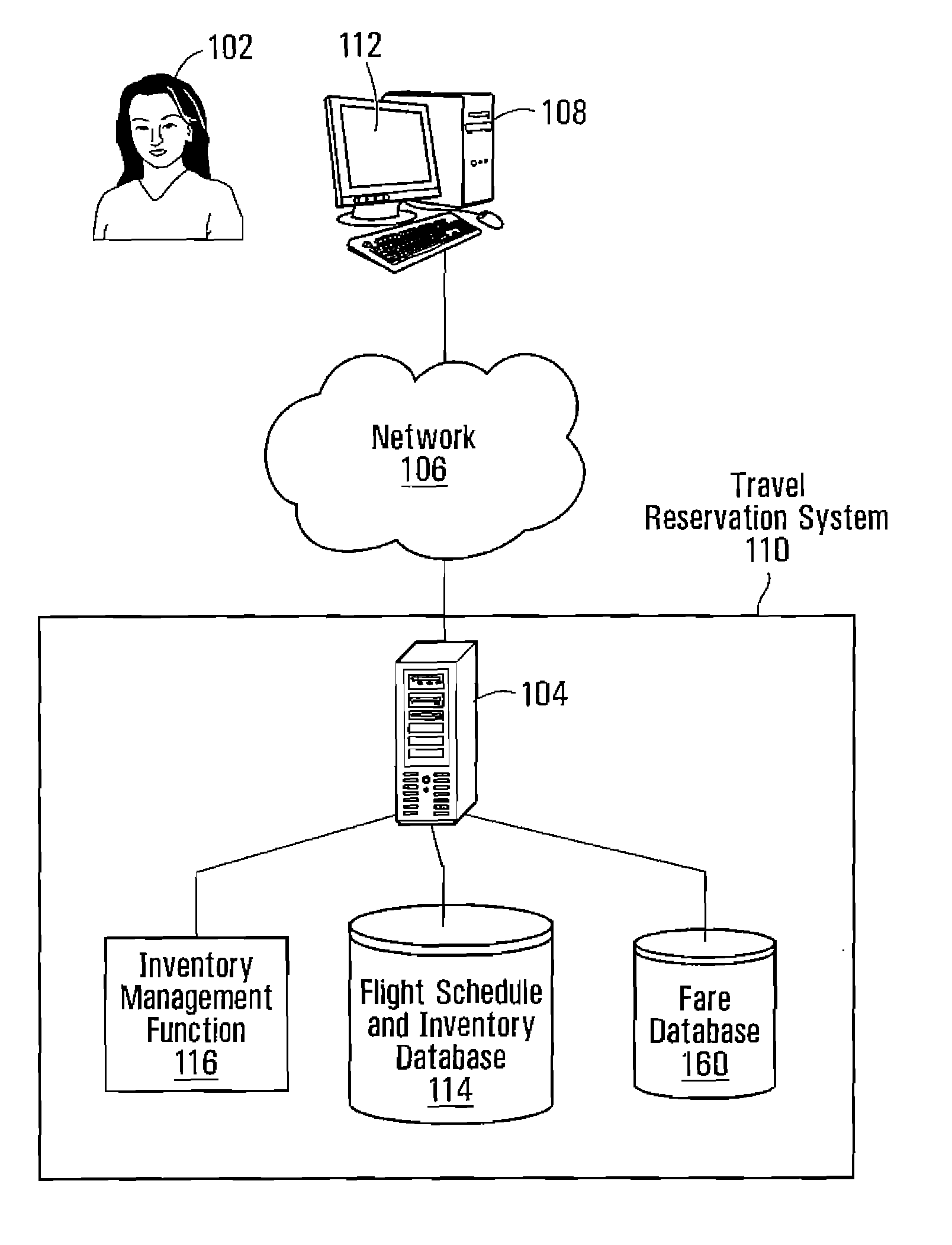

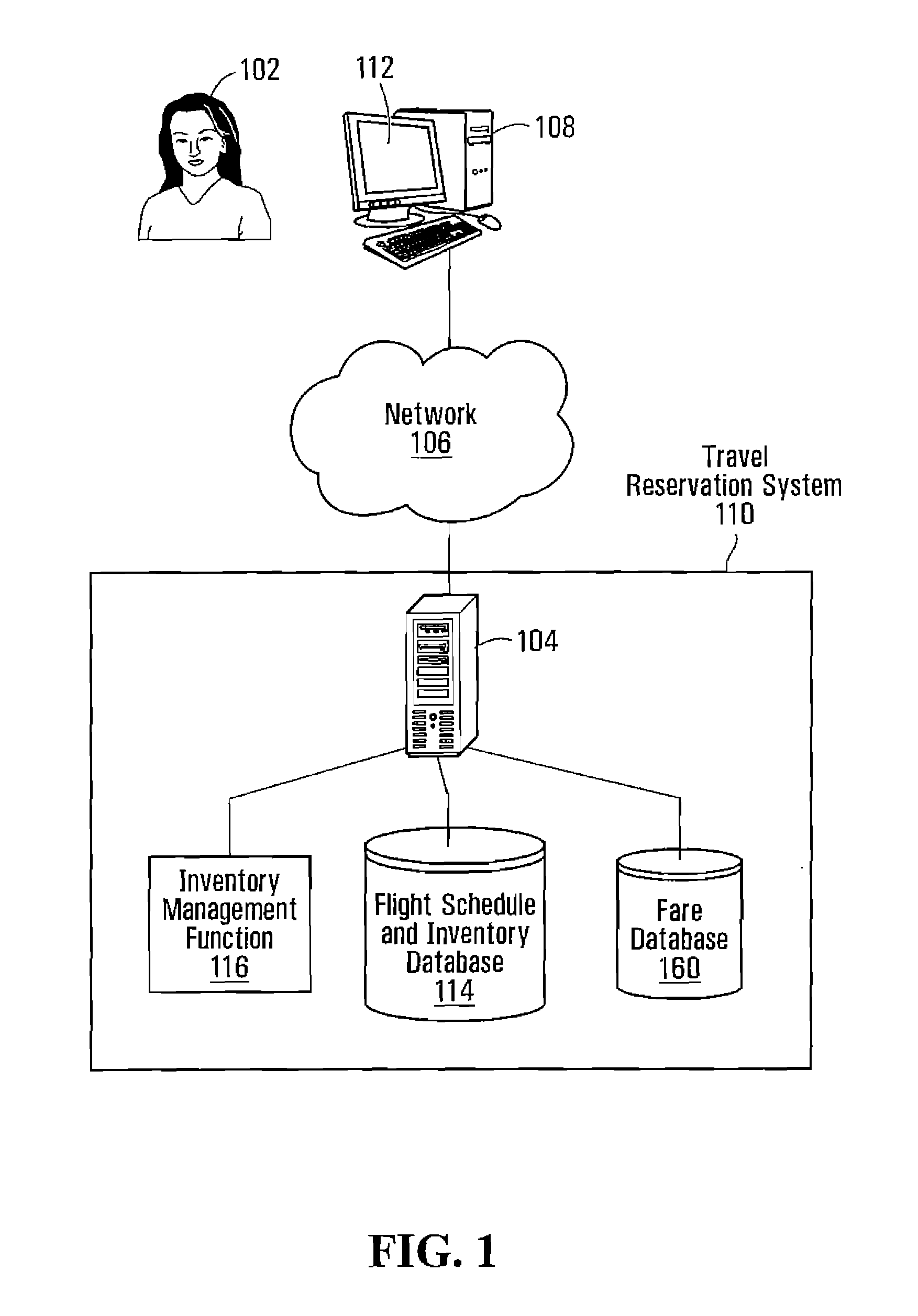

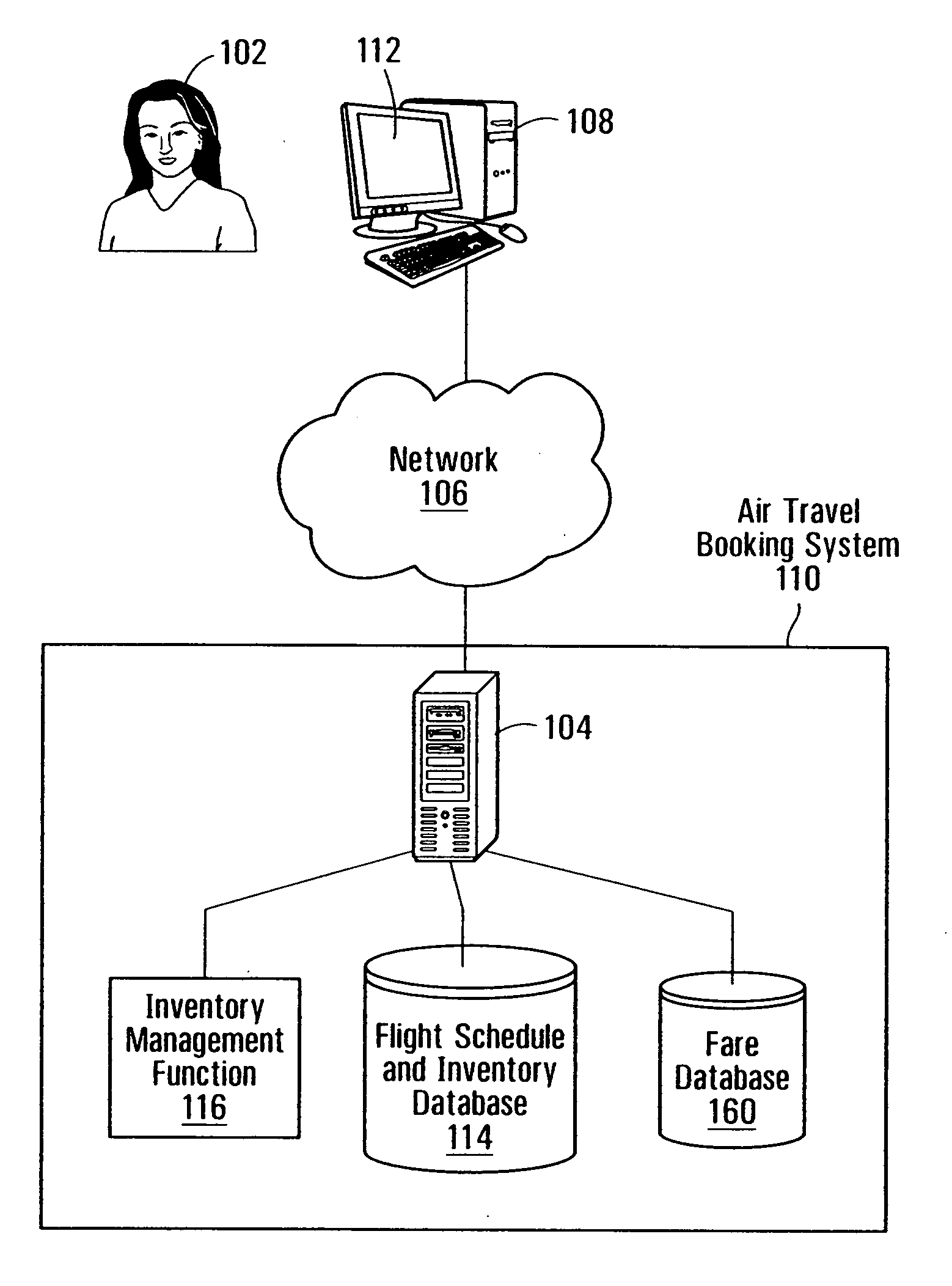

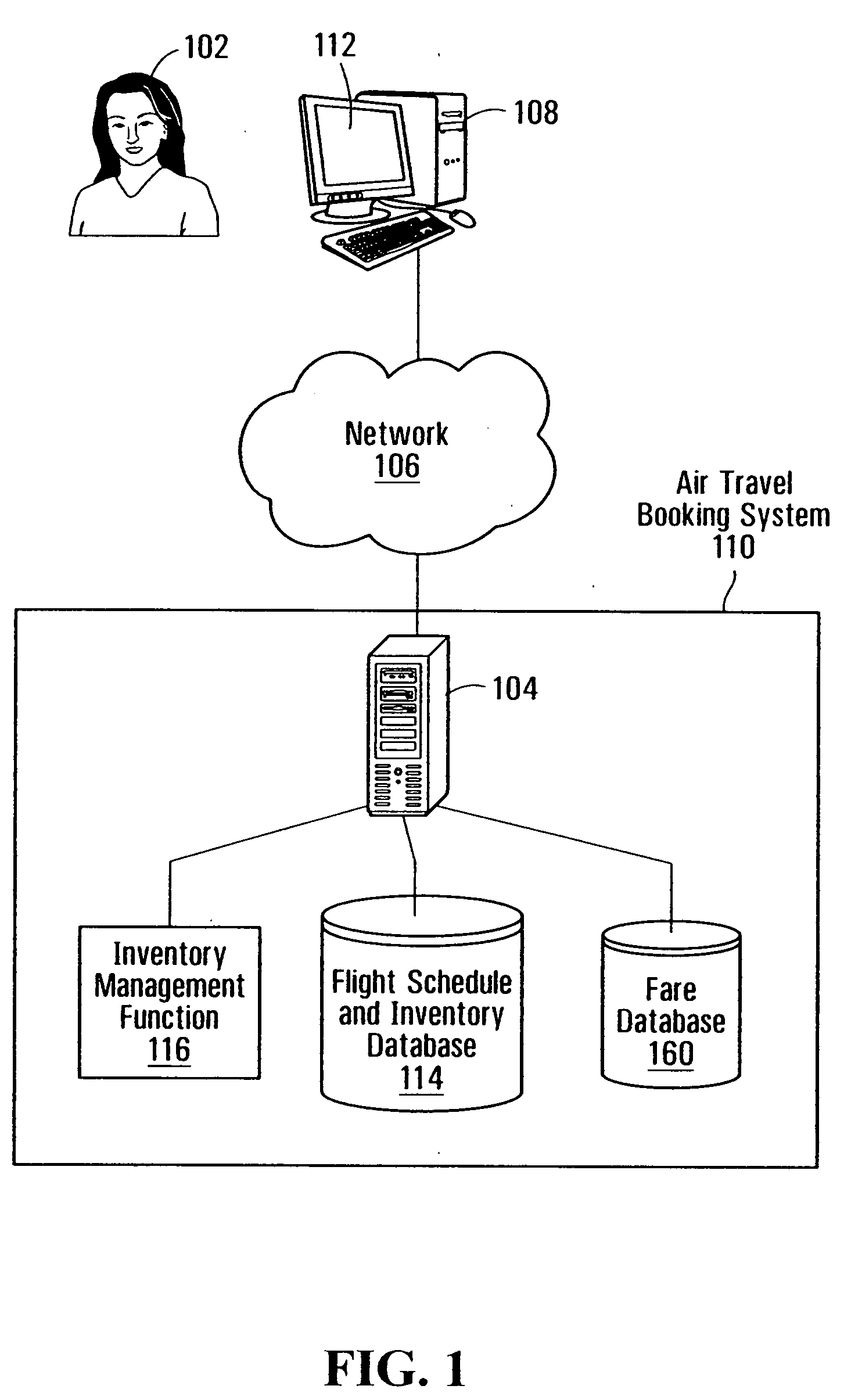

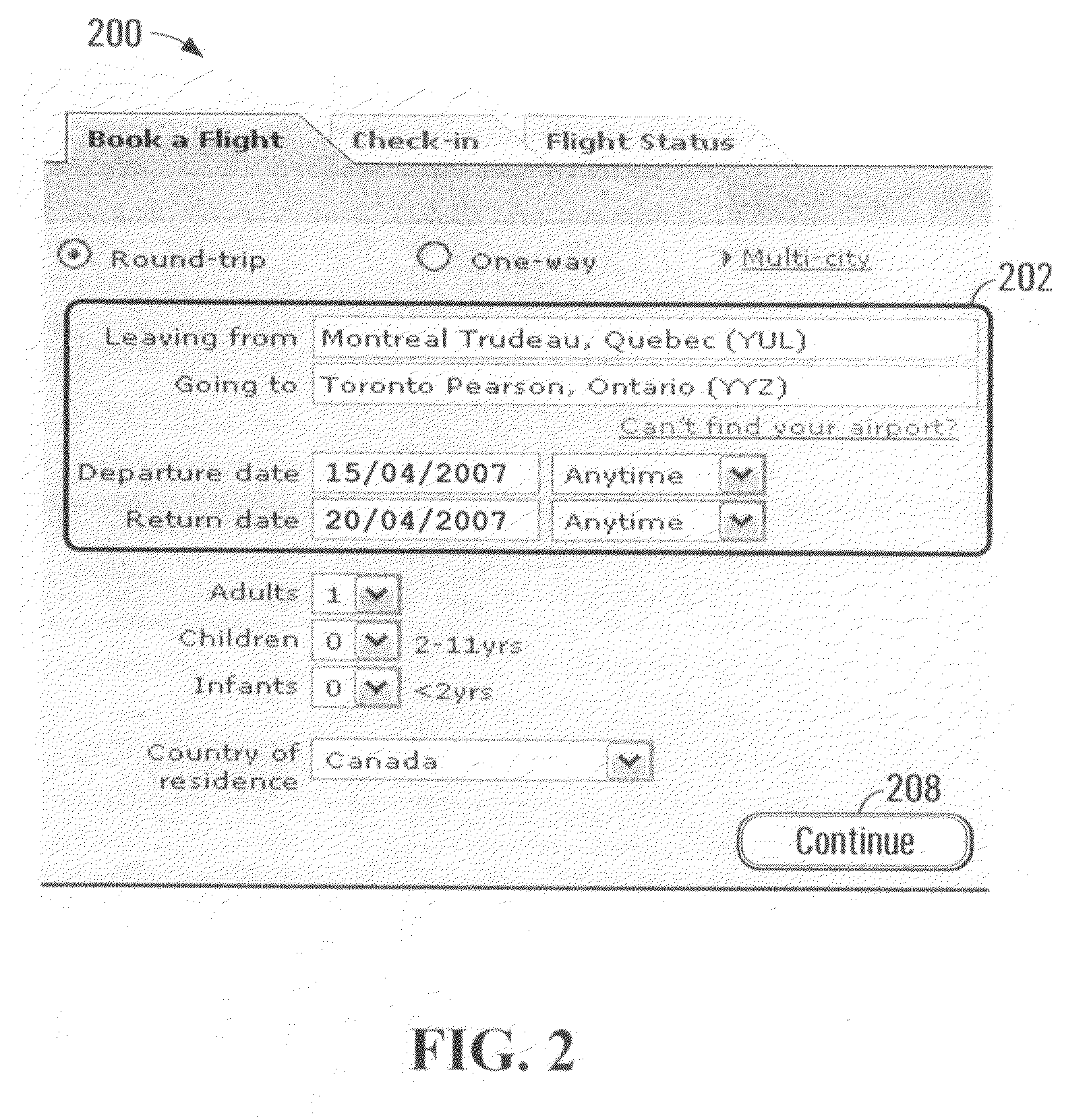

Method and system for customization of air travel

InactiveUS20080027767A1ReservationsBuying/selling/leasing transactionsGraphical user interfaceEngineering

Method, architecture and computer-readable medium to enable a user of a computer-implemented graphical user interface (GUI) to purchase air travel services. The method comprises receiving air travel parameters submitted via the GUI; receiving a selection made via the GUI, the selection being indicative of at least one selected service attribute from a service attribute set; determining a core price for a flight meeting said air travel parameters; determining at least one price differential associated with the at least one selected service attribute; determining a purchase price based on the core price and the at least one price differential; causing the purchase price to be displayed via the GUI; and causing said flight to be booked in response to receipt of a confirmation made via the GUI of an intent to purchase a ticket for said flight at the purchase price.

Owner:AIR CANADA

System, method, and non-transitory computer-readable storage media related to providing real-time price matching

Techniques related to retail transaction are disclosed. The techniques involve comparing the prices associated with a customer order with the prices being charged by competitors prior to the transaction being completed. The customer is given the opportunity to apply a credit based on the difference in prices being charged by the retailer and competitors, to the transaction.

Owner:WALMART APOLLO LLC

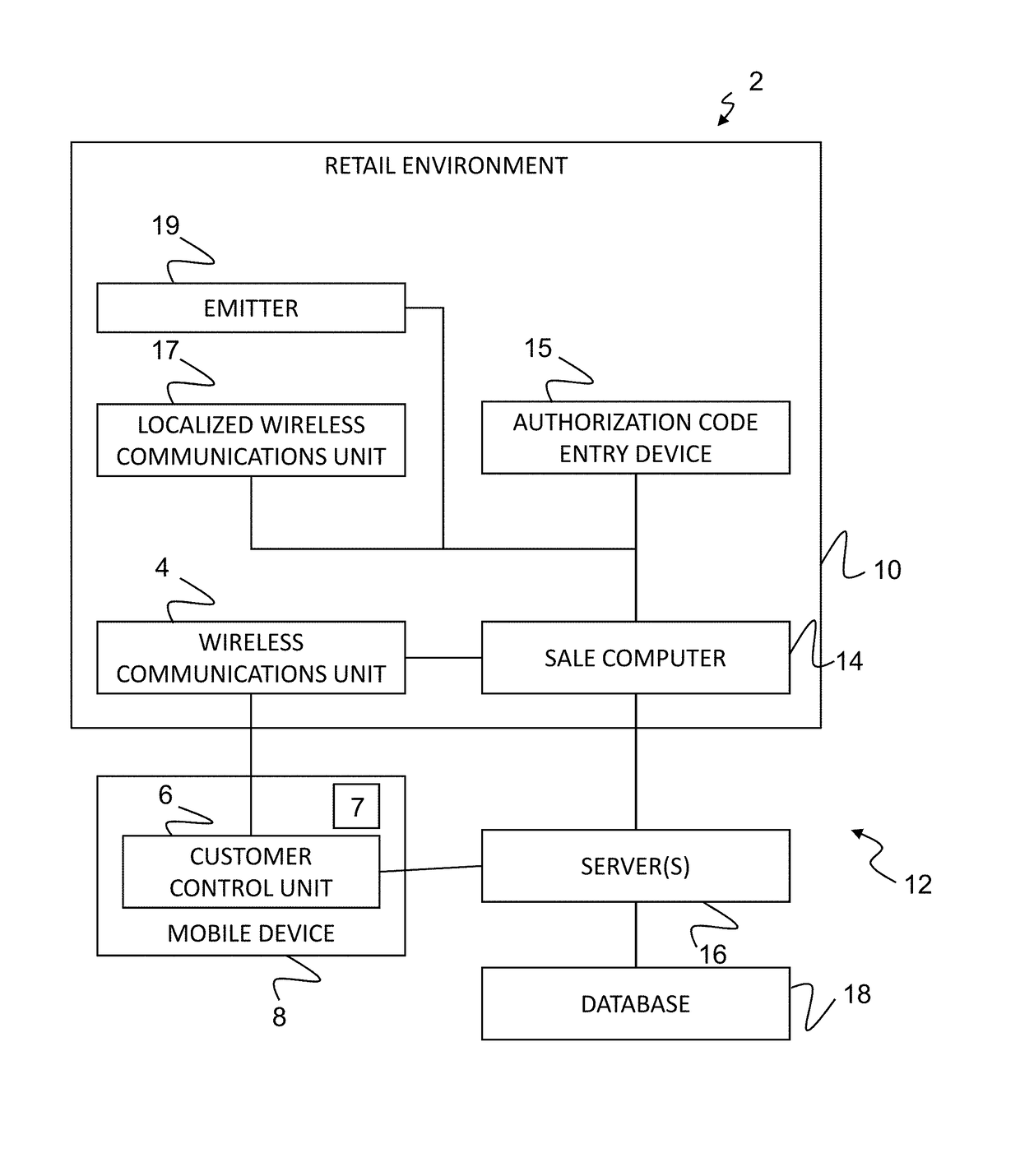

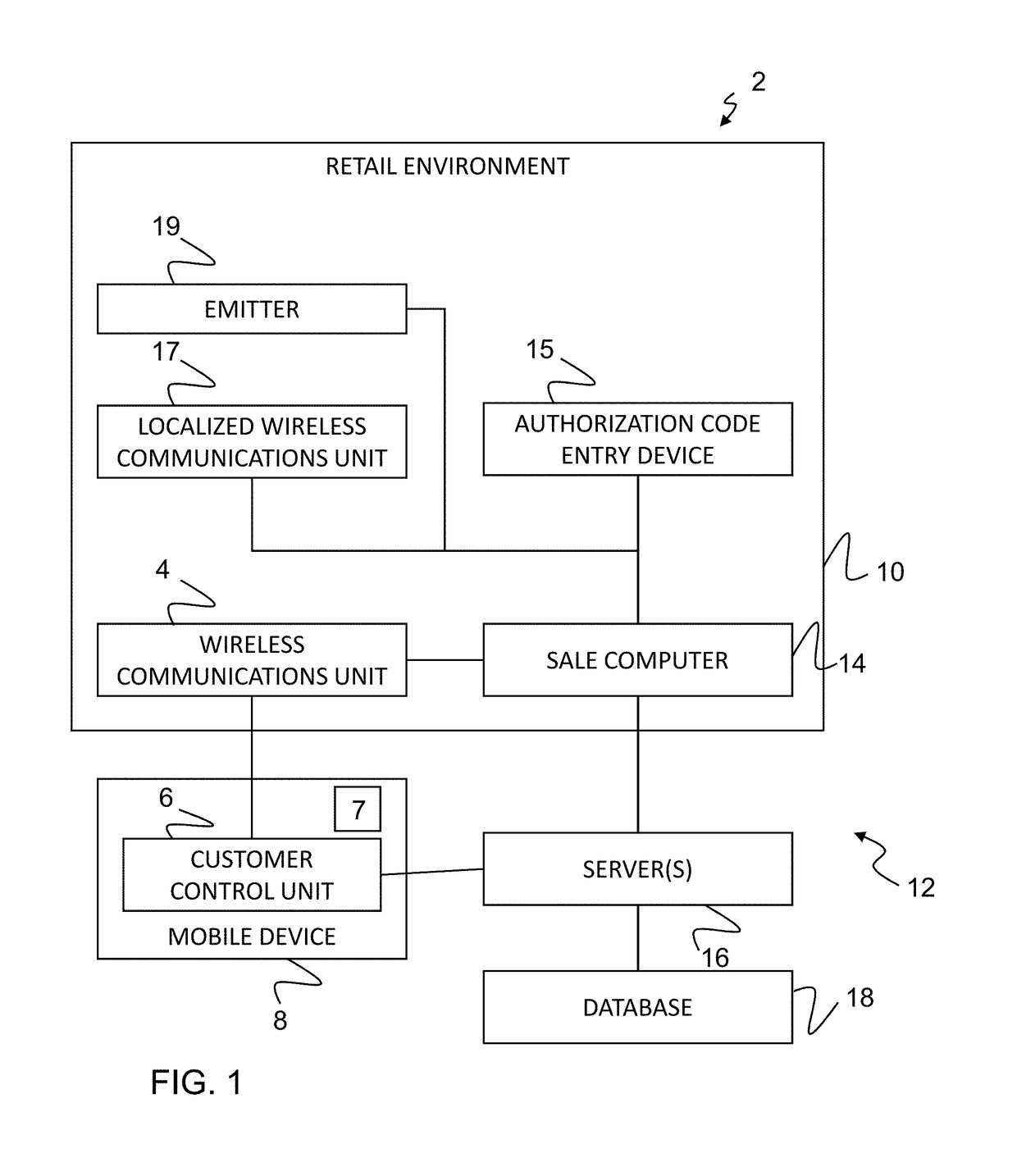

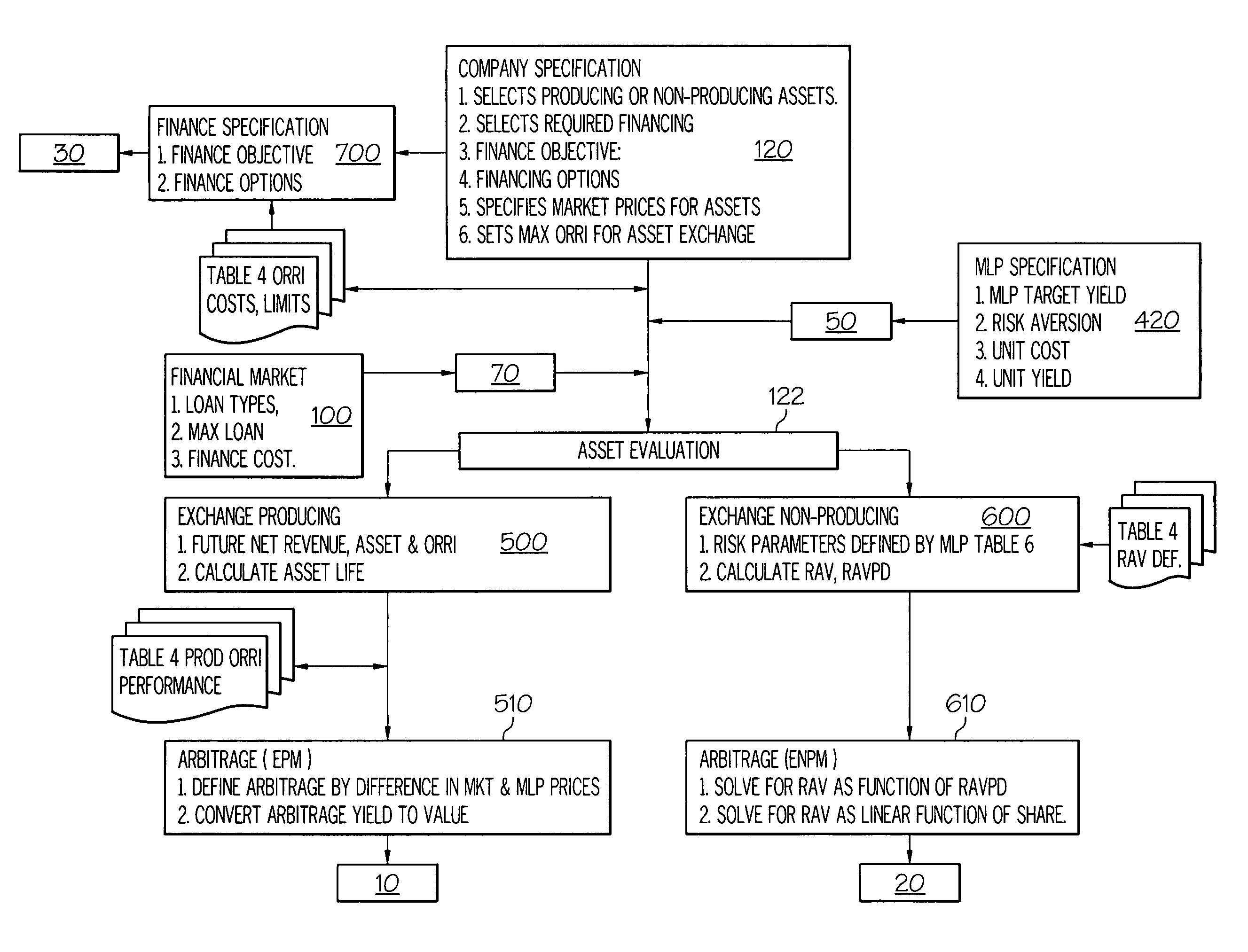

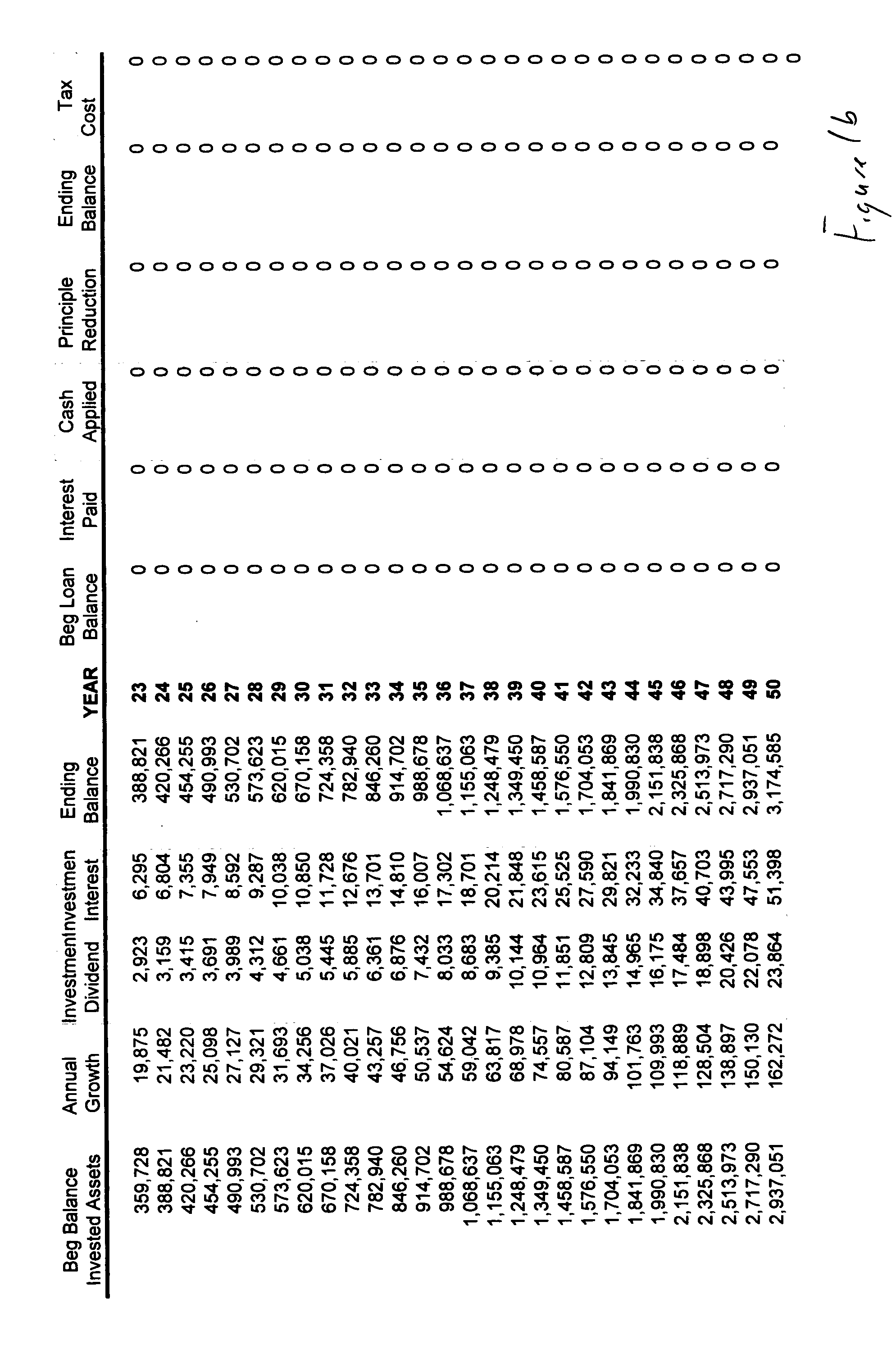

MLP financing system

Owner:RAMSEY TERRY

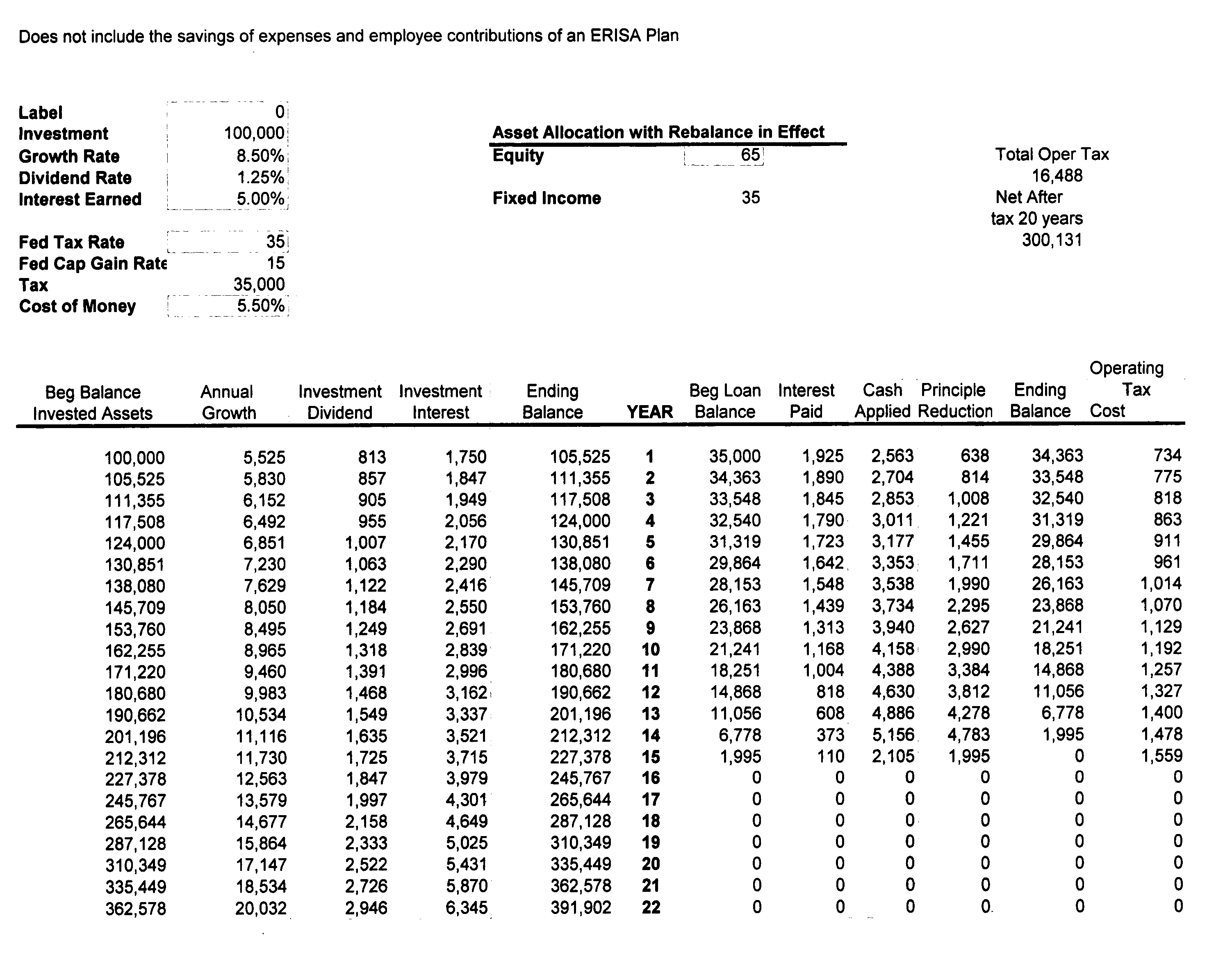

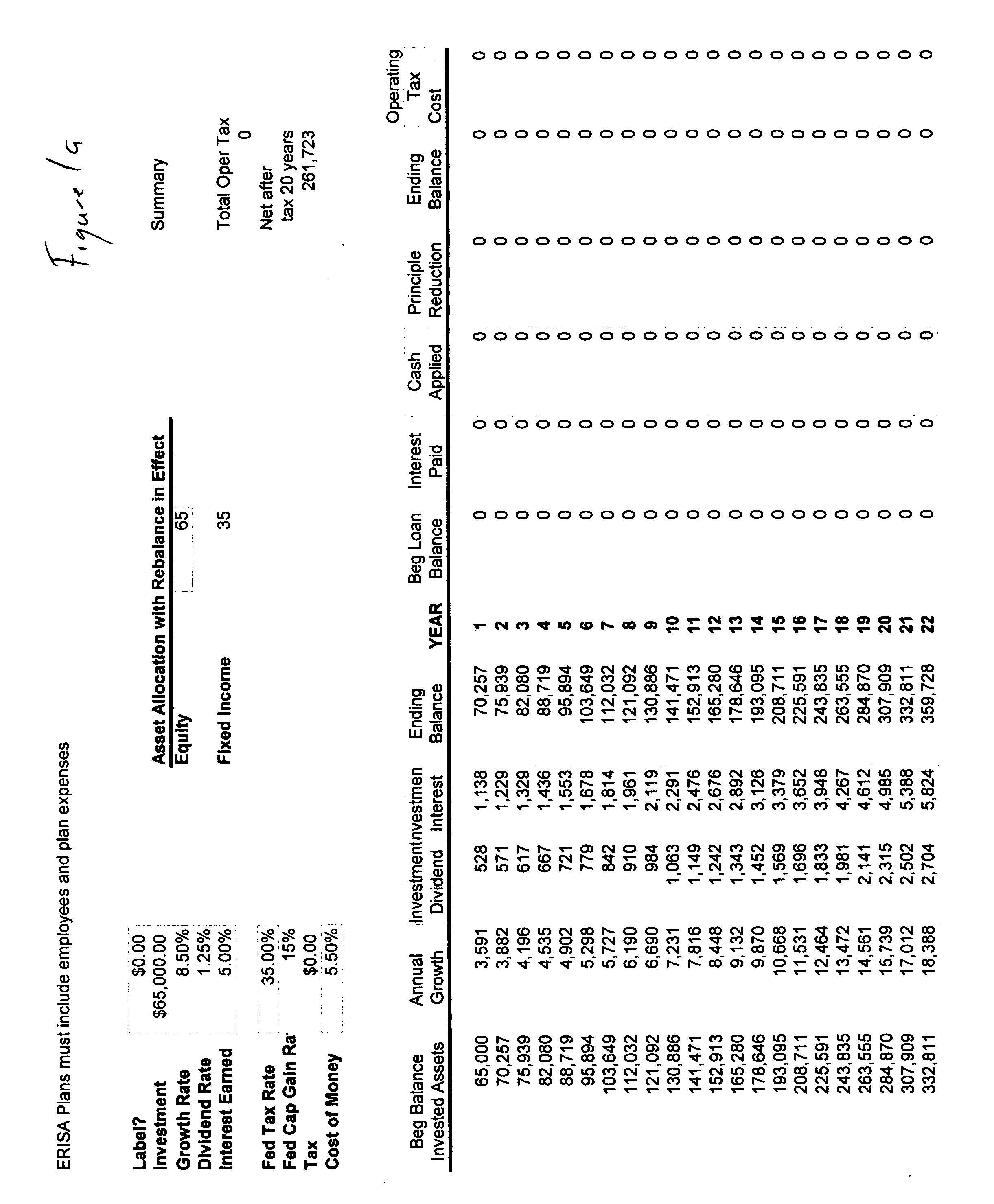

Tax attenuation and financing

InactiveUS20060242045A1Without diminishment of investment earning powerSufficient amountFinancePrice differentialEngineering

A method for tax attenuation in accordance with the present invention matches an income stream from an investment to a cost of debt to hold the cost of the tax in abeyance. An amount is invested to gain returns. An amount is borrowed at a cost to pay the tax liability. An investment portfolio is established in order to create a positive spread between the returns on the invested amount and the cost of the borrowed amount such that the periodic returns on the invested amount is sufficient to pay at least the periodic interest payments due on the borrowed amount. In addition, the investment portfolio is established with investments sufficient to cover the margin of the borrowed amount. In addition, the returns of the investment are used to pay interest on the borrowed amount. Finally, the returns of the investment are used to pay off, in full, the amounts borrowed.

Owner:TAMBY3

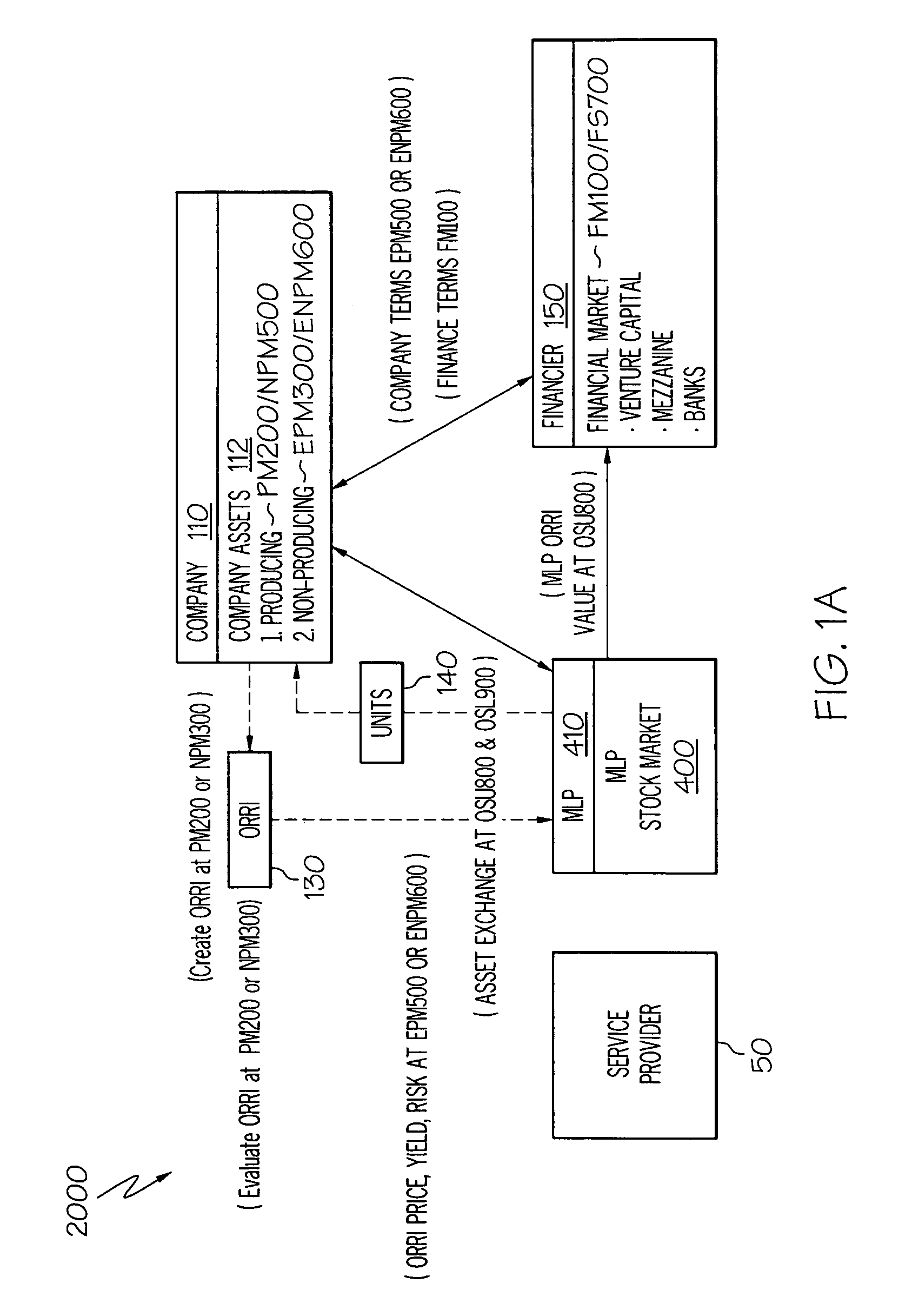

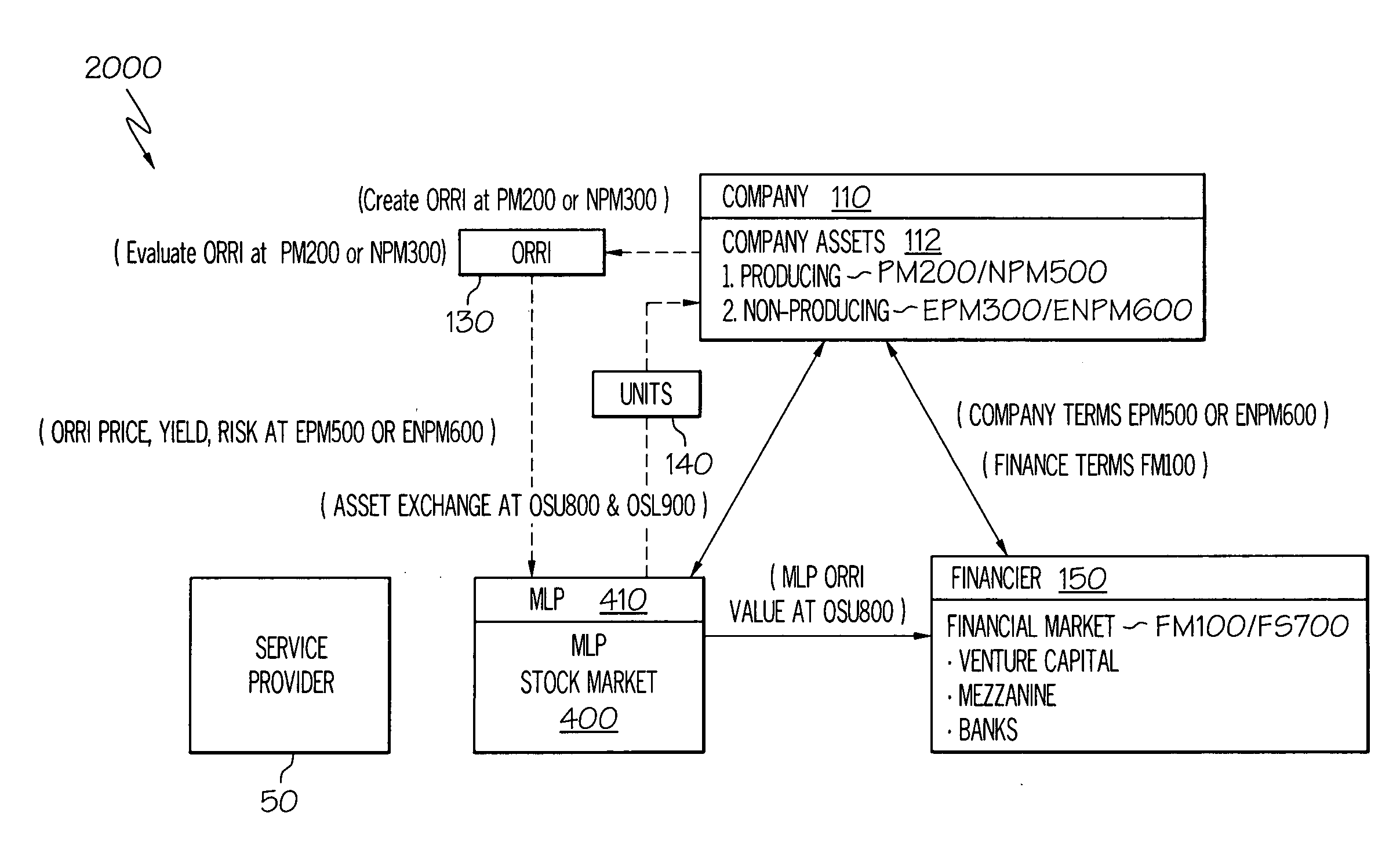

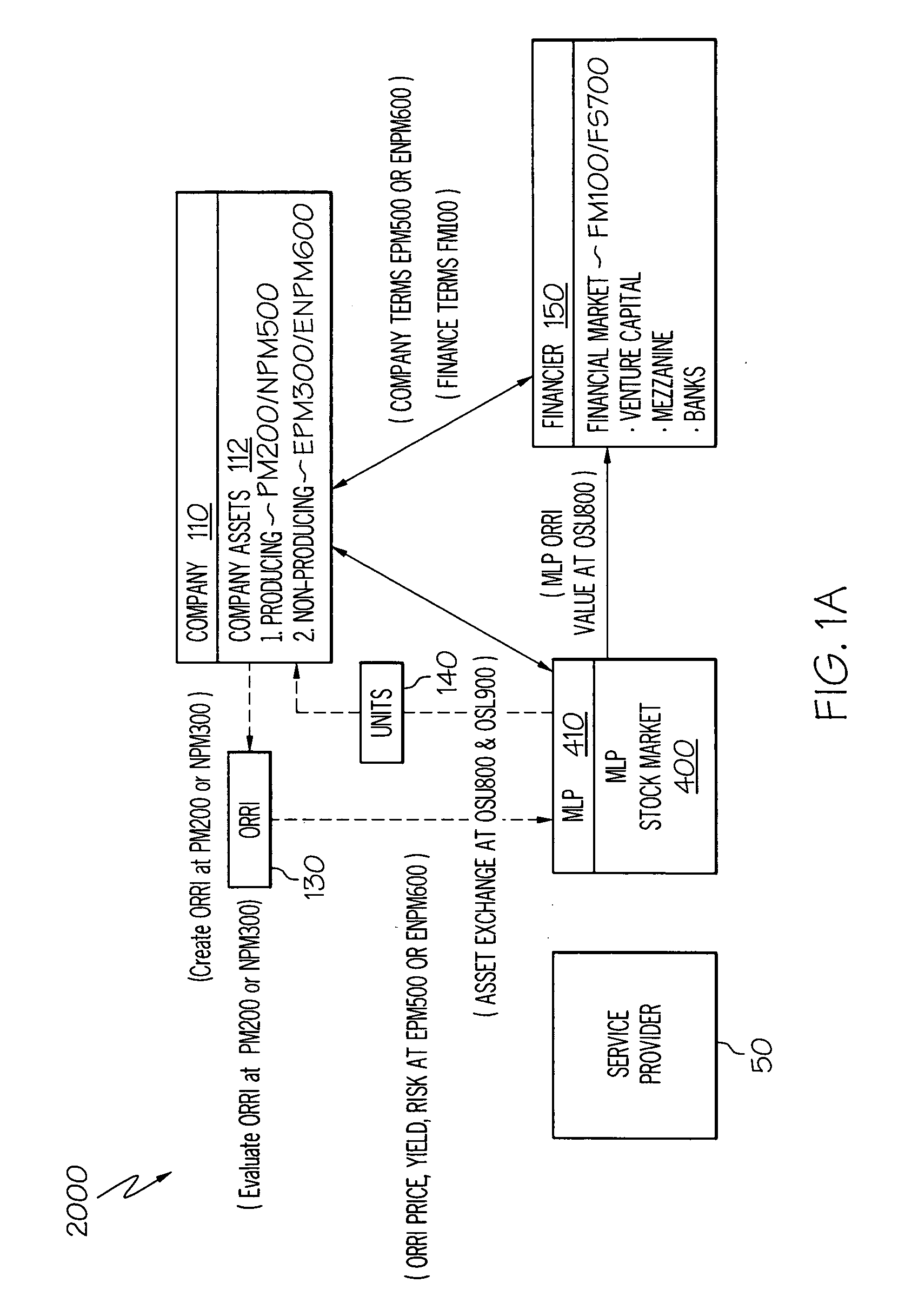

MLP Financing System

The MLP Financing System extends the properties of shares in an publicly traded entity that does not generate UBITs to create a new asset class that permits the underlying assets to be specifically structured for financing. MLP Financing System requires a minimum of three markets entering into transactions involving a company, a publicly traded entity, and a third entity in the financial industry. Each market establishes an asset value, price, yield, and risk. Asset price differentials between markets identify arbitrage opportunities. The market asset value, price, yield, risk, and financial constraints of entities operating in those markets provide the initial transaction specifications between company-MLP, financier-MLP, and company-financier.

Owner:RAMSEY TERRY

System and method for providing relative price point incentives based upon prior customer purchase behavior

The invention provides a system, computer program, and method for generating price point based incentives comprising; determining a category specific price point (620) associated with a dominant competitive brand and a client brand; generating an incentive (630) for said client brand based upon said price point and an anticipated price differential (640).

Owner:CATALINA MARKETING CORP

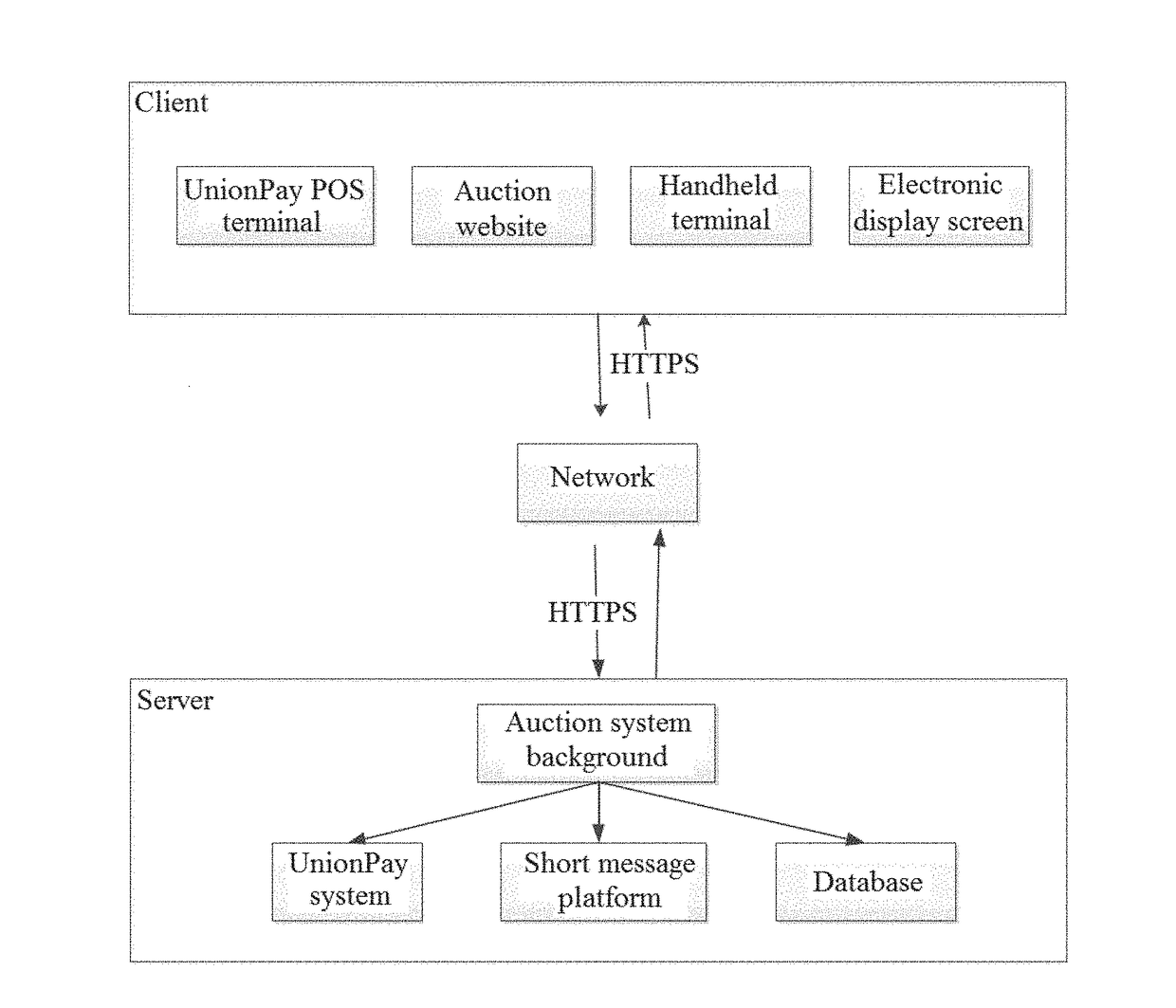

Network auction method and system for establishing a bidding reward mechanism

InactiveUS20180189867A1Maximize the benefitsIncrease transaction rateWeb data indexingTransmissionPrice differenceComputer science

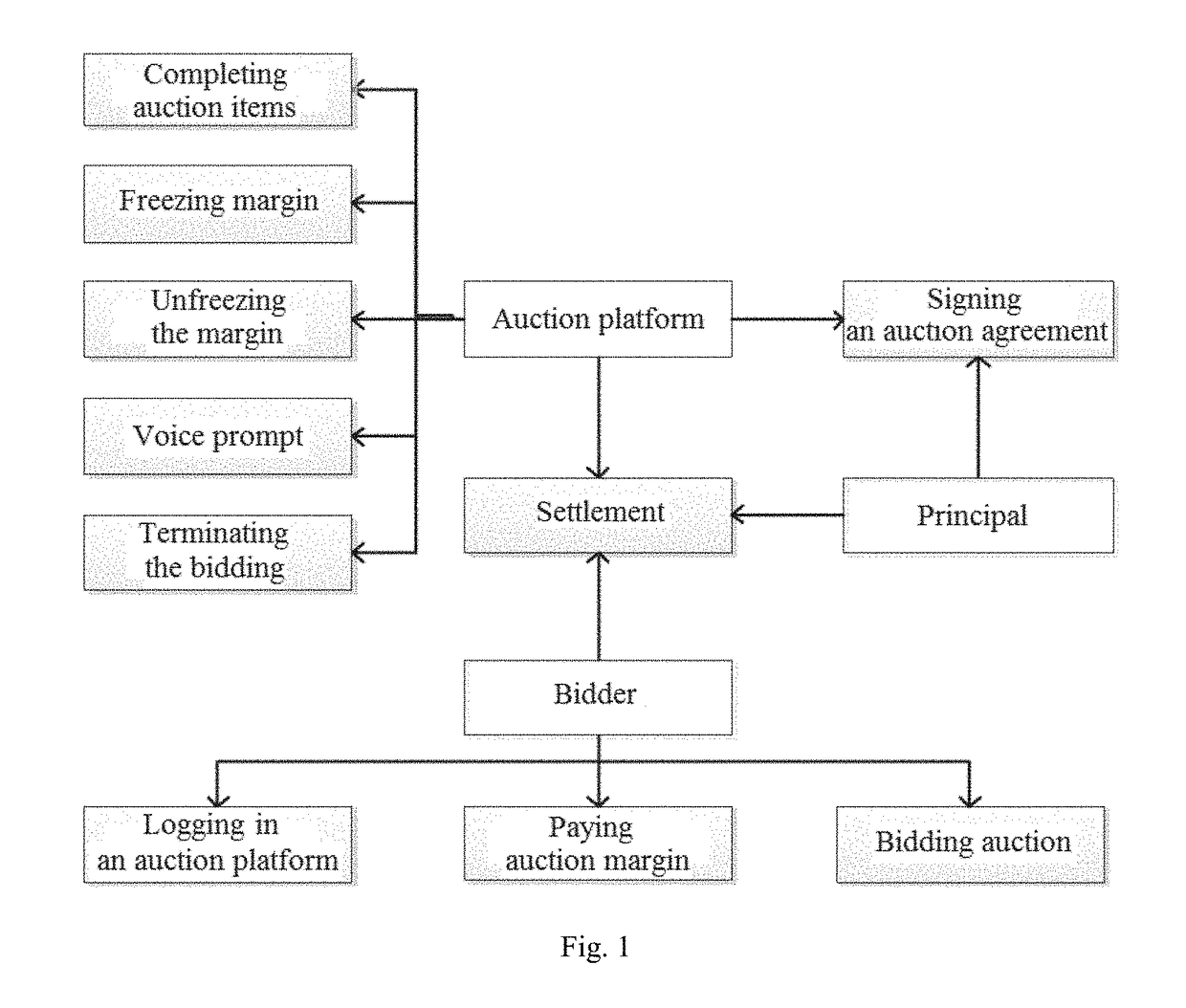

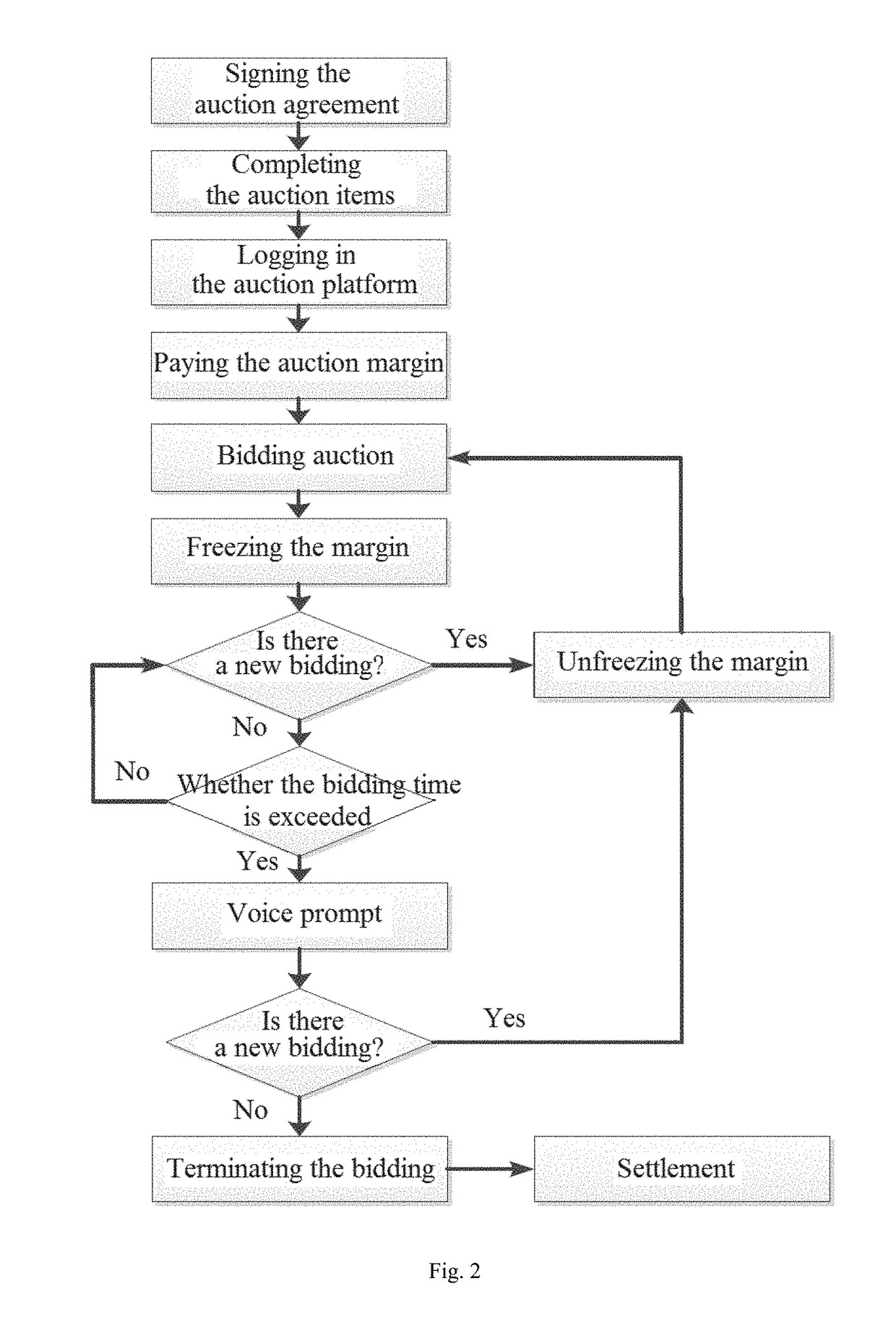

A network auction method and system for establishing a bidding reward mechanism, the bidding reward mechanism is as follows: a principal entrusts an auctioneer to reward bidders so as to enable the bidders to enjoy part of price difference within a bidding increment; and in an auction, an auction platform freezes margin which is equal to or accounts for a certain proportion amount of bidding of one bidder every time the bidder bids, the frozen margin is unfrozen only until a new auctioneer bids, and so on. The method and system realize transparency and rigorousness, security and reliability, openness, impartiality and fairness, and can activate an auction market and serve the public and economy.

Owner:HU GANG

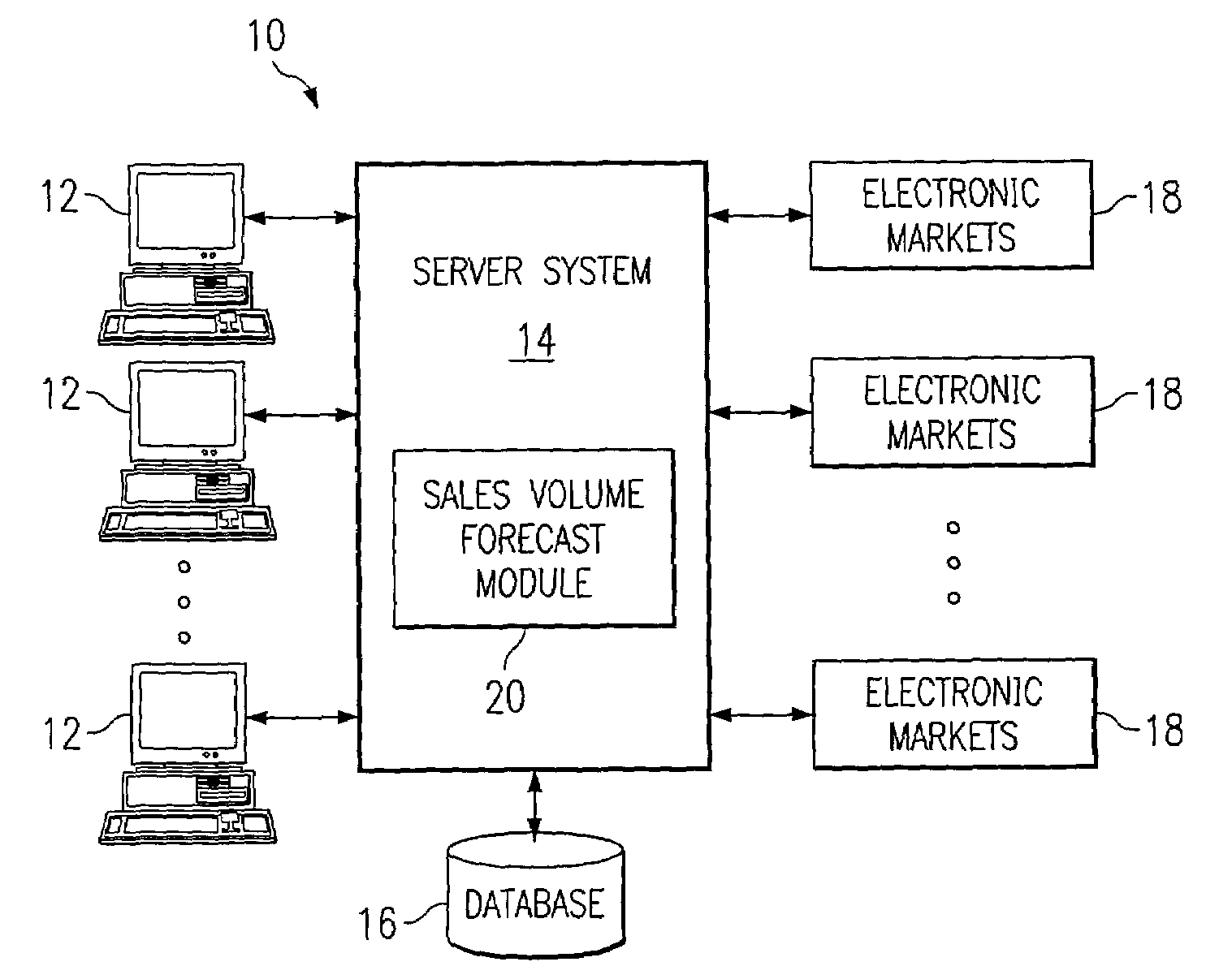

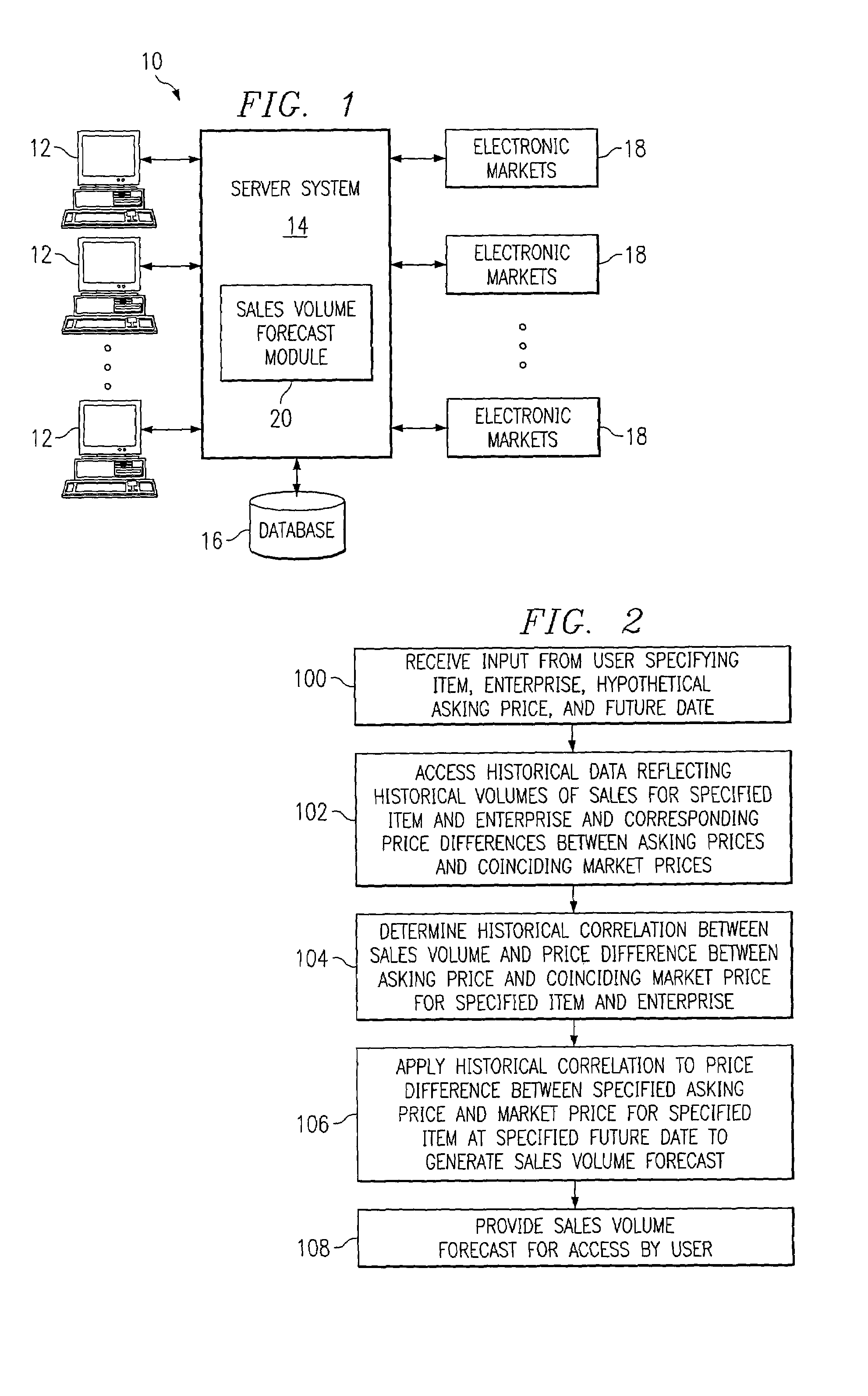

Generating a sales volume forecast

ActiveUS7324955B1Disadvantages can be reduced eliminatedImprove one and more aspectMarket predictionsSpecial data processing applicationsUser inputPrice difference

A method for generating a sales volume forecast includes receiving user input specifying a hypothetical asking price and a future date and accessing, for each of multiple past time periods, historical data reflecting a sales volume for an item over the past time period and a corresponding price difference between an asking price and a coinciding market price for the item, the price difference also being associated with the past time period. The method also includes determining a historical correlation for the item between sales volume and price difference between asking price and coinciding market price, accessing market data reflecting a future market price for the item associated with the specified future date, determining a price difference between the specified hypothetical asking price and the future market price for the item, applying the determined historical correlation to the determined price difference to generate a sales volume forecast, and providing the generated sales volume forecast for access by a user.

Owner:BLUE YONDER GRP INC

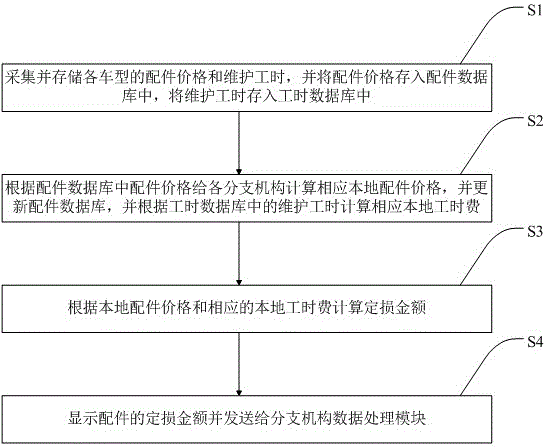

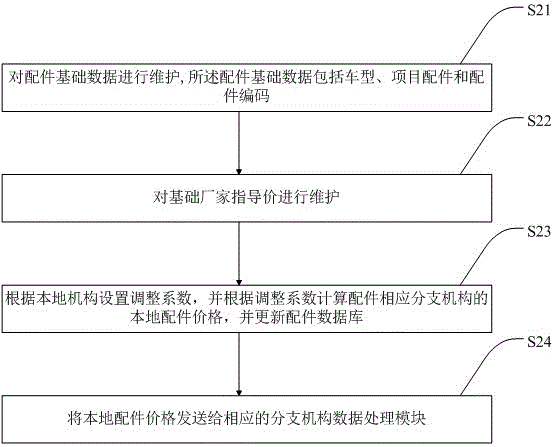

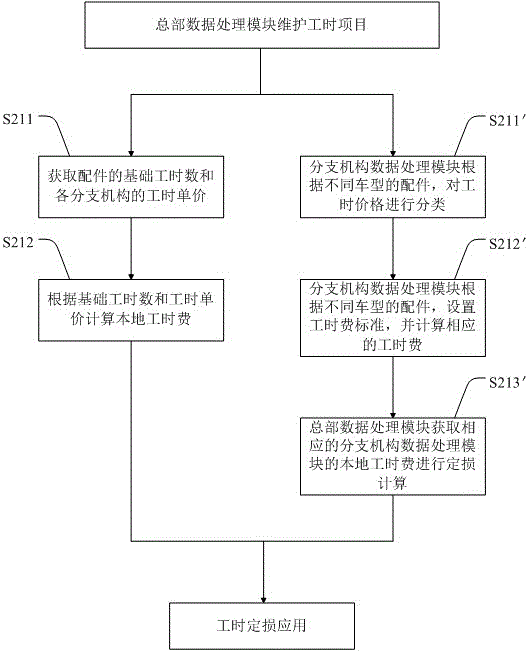

Local loss assessment price processing method and system based on vehicle insurance intelligent loss assessment platform

InactiveCN106779799ASolve the price difference problemEasy to acceptFinanceLogisticsMan-hourPrice difference

The invention discloses a local loss assessment price processing method and system based on a vehicle insurance intelligent loss assessment platform. The local loss assessment price processing method comprises the steps of acquiring and storing accessory prices and maintenance man-hours of each vehicle model, storing the accessory prices into an accessory database, and storing the maintenance man-hours into a man-hour database; calculating corresponding local accessory prices for each branch mechanism according to the accessory prices in the accessory database, and updating the accessory database; calculating the corresponding local man-hour cost according to the maintenance man-hours in the man-hour database; and calculating the loss assessment amount according to the local accessory prices and the corresponding local man-hour cost. According to the invention, basic data is maintained through utilizing a headquarters data processing module, and the accessory prices and the man-hour cost of each branch mechanism are calculated by utilizing the headquarters data processing module at the same time, so that each branch mechanism is enabled to only need to receive loss assessment prices sent by the headquarters, each mechanism is supported to maintain th local price, and the price is enabled to be more reasonable. Meanwhile, a problem of price difference among the mechanisms is solved, so that the price can be better accepted by customers.

Owner:CHINA PING AN PROPERTY INSURANCE CO LTD

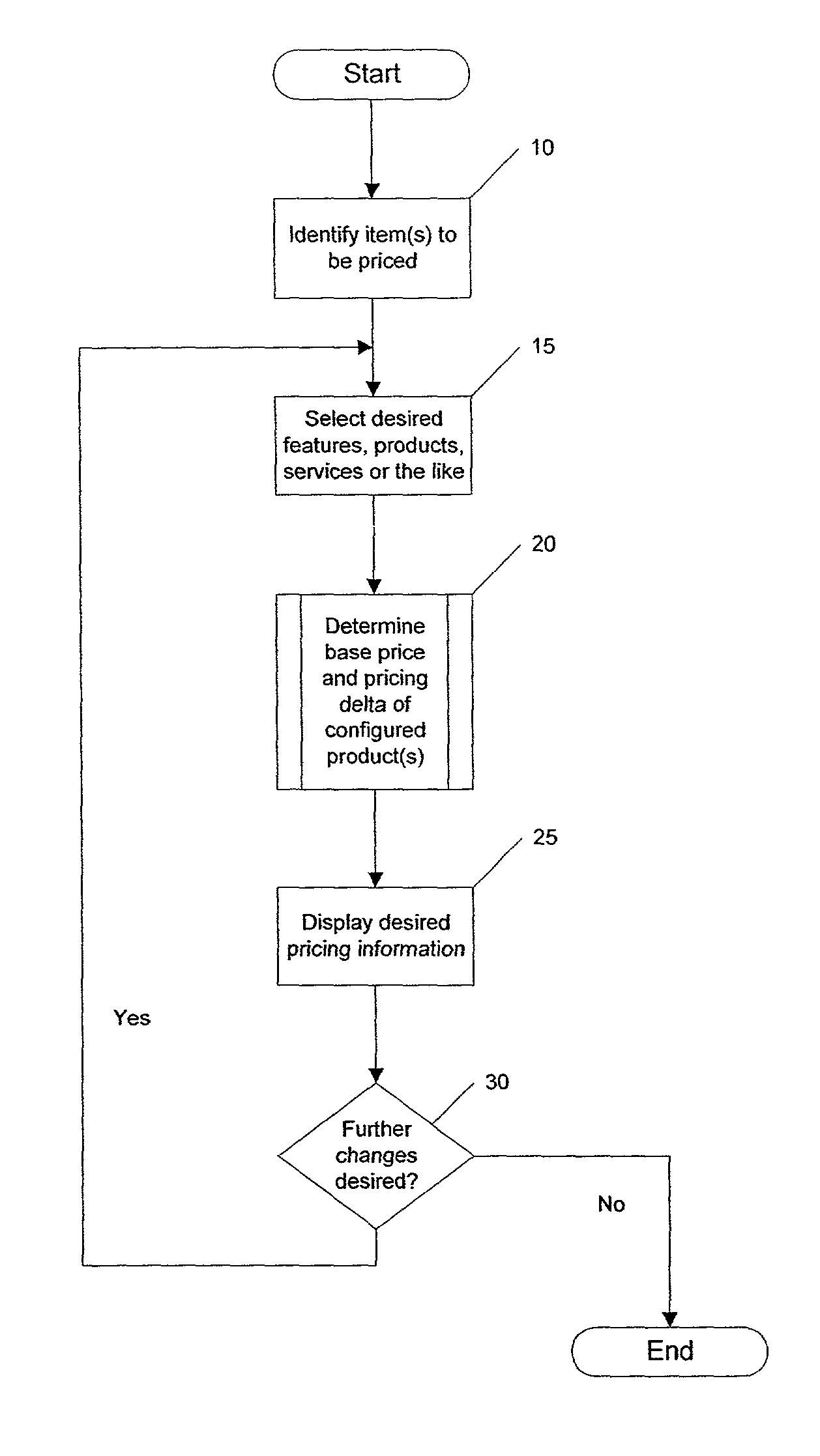

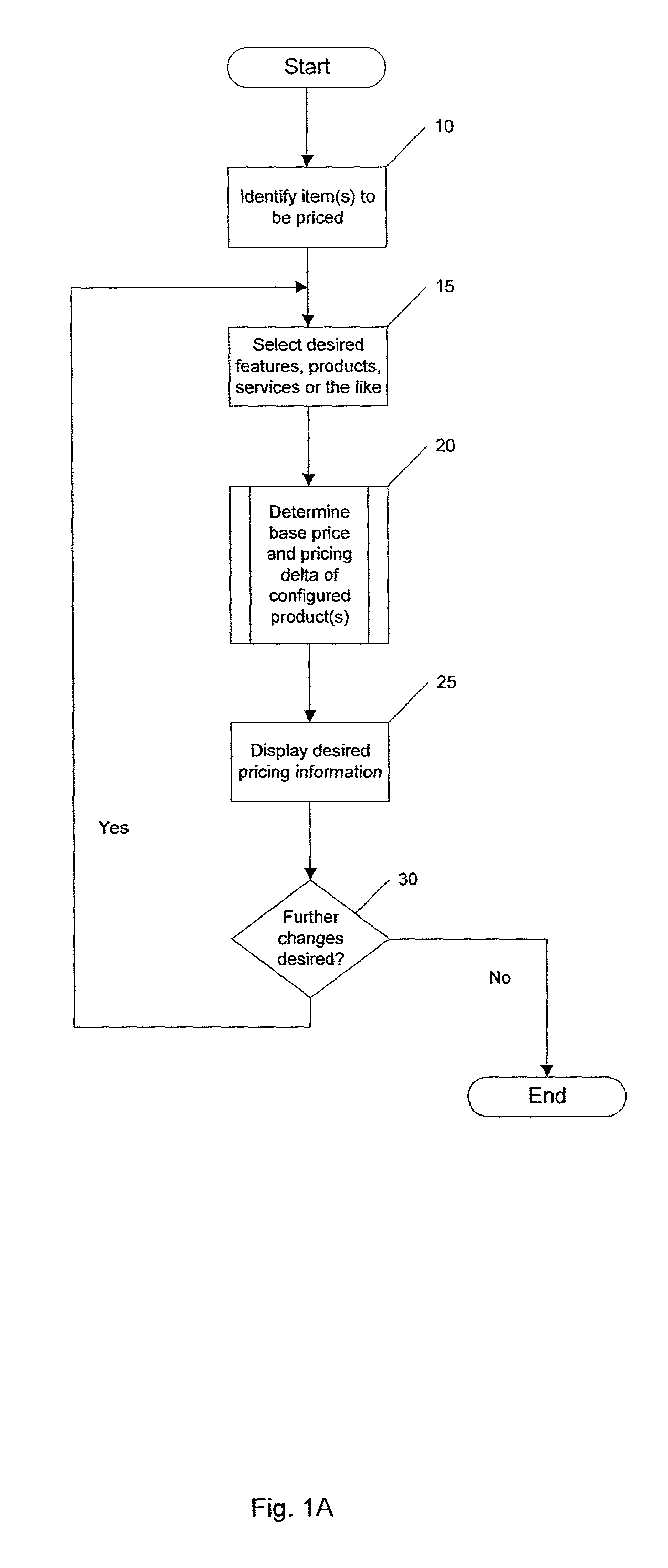

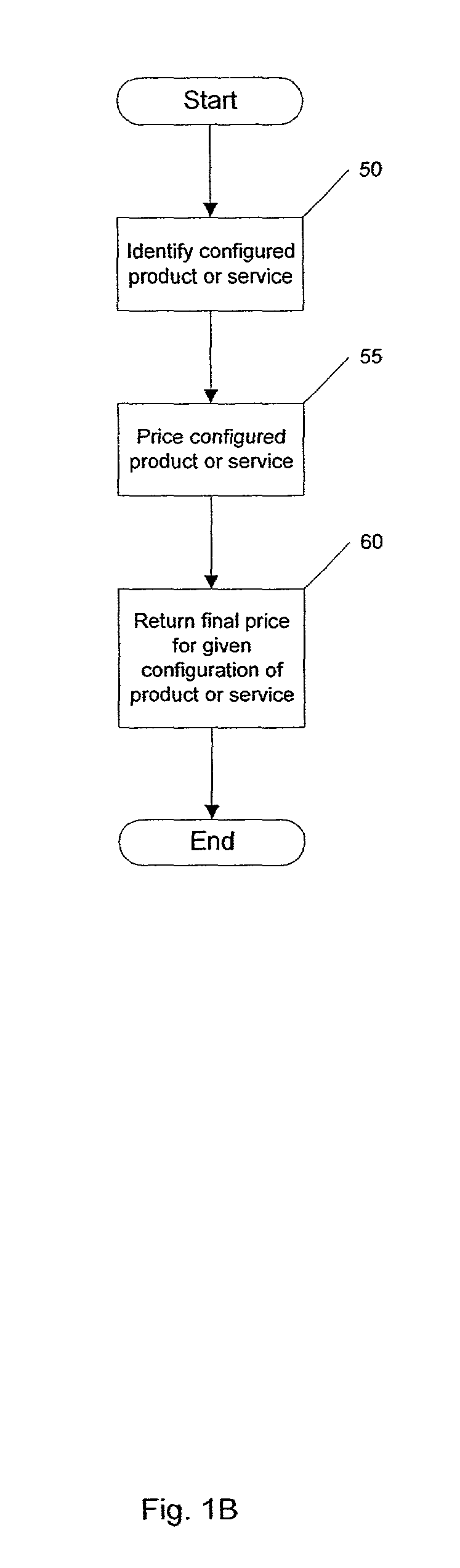

Method and apparatus for efficient delta pricing

ActiveUS7584155B1Enjoyable buying experienceFast and efficientMarket predictionsResourcesPrice differenceComputer science

A method includes generating a delta price and generating a final price using the delta price. A process and system provide an ability to determine a product's final price with a selected set of features in which multiple configurations are to be generated. The ability to determine such final prices can be based on the ability to determine the change in price between one configuration of a product and that of another product configuration (e.g. the product configured with the desired feature(s)). A customer is able to select one or more features, and so view the effect on the product's final price, as well as compare the prices (and incremental price differences) between various configurations of a given product. This increases the likelihood of the purchase being made, because it provides the potential purchaser with the final price earlier in the sales cycle.

Owner:VERSATA DEV GROUP

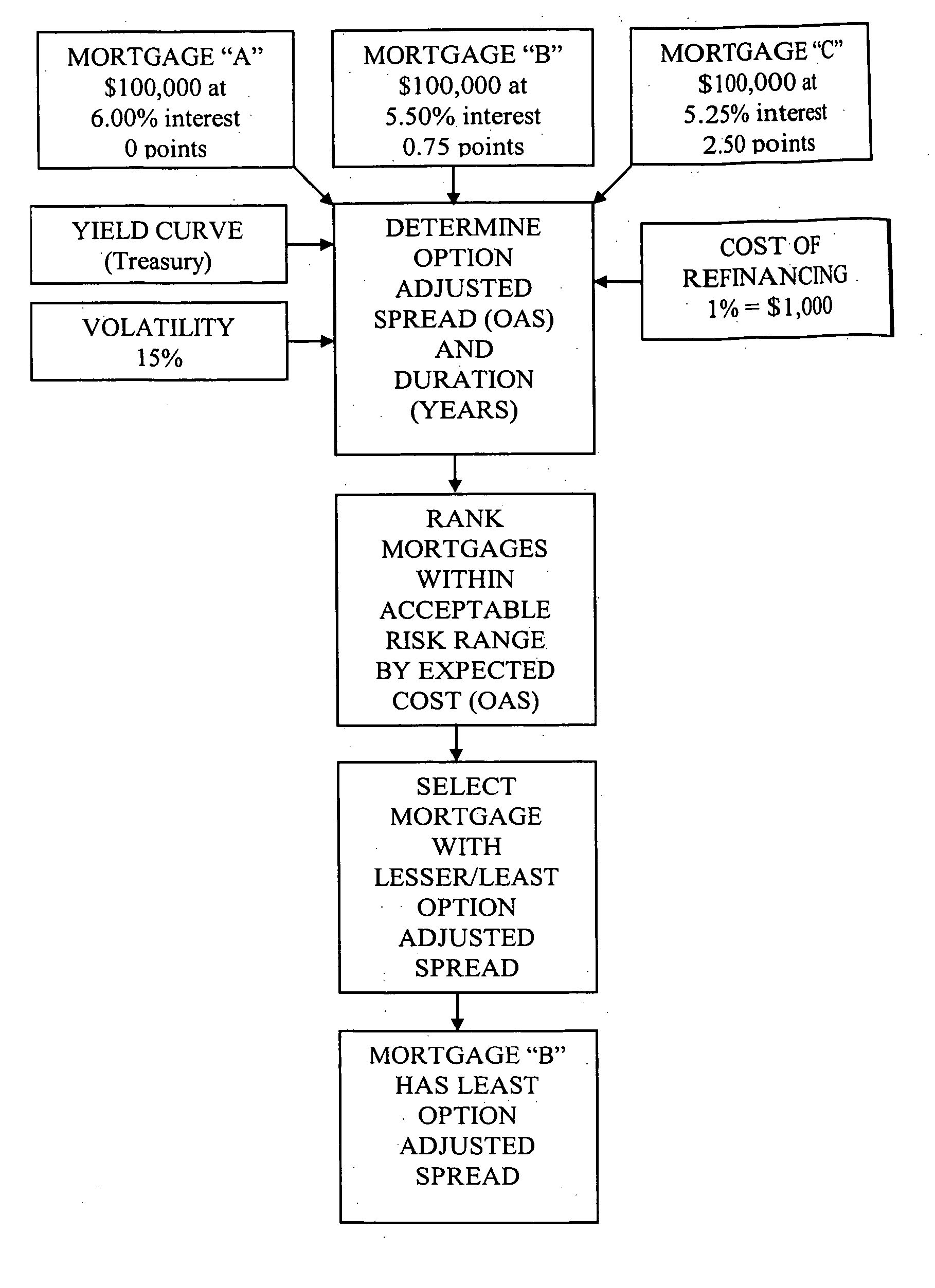

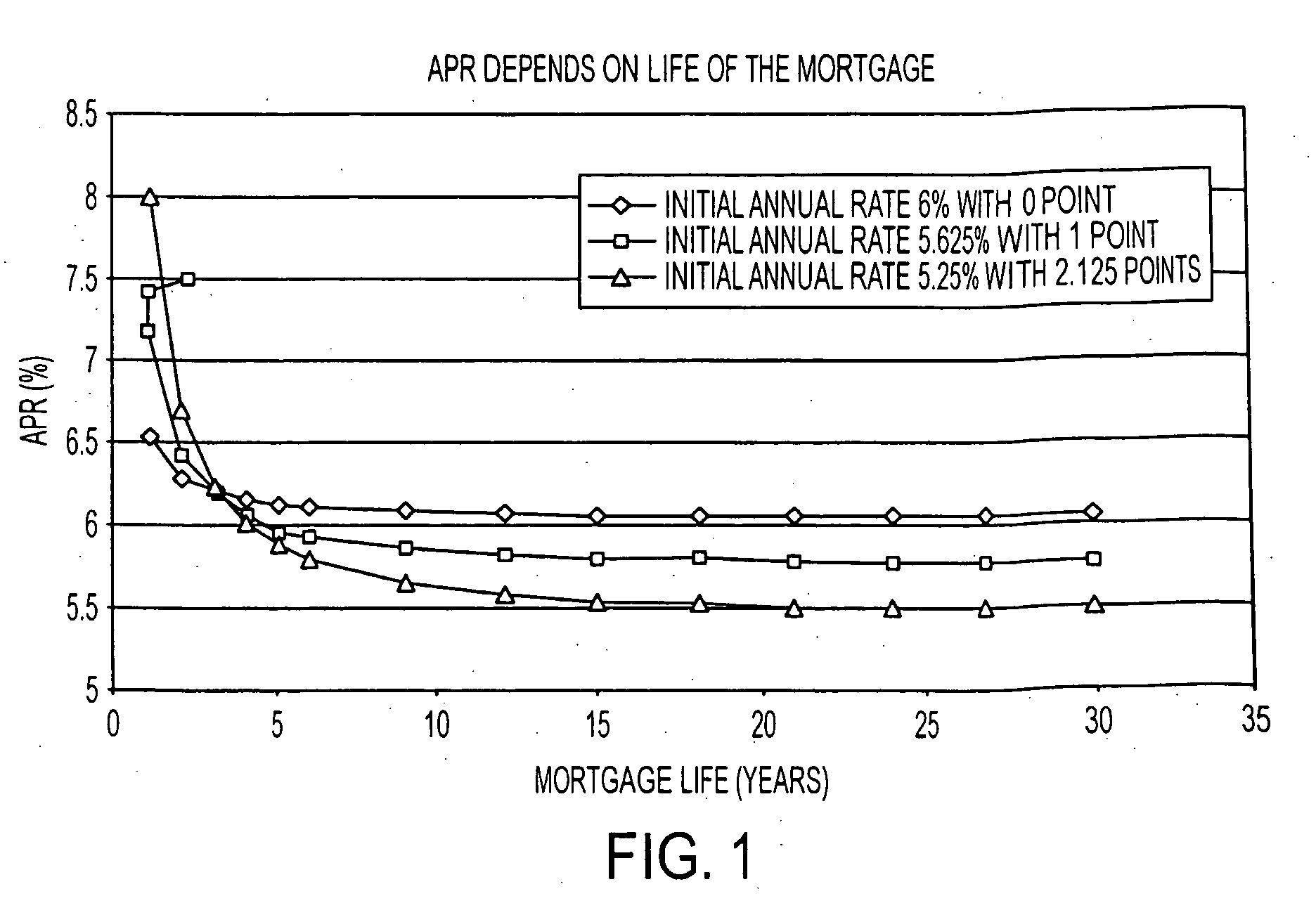

Method and system for determining which mortgage choice is best for a consumer

A method and system for selecting a preferred debt instrument (e.g., mortgage) for an individual consumer, where the option adjusted spreads (OAS) and risk measures of a plurality of debt instruments are determined and ranked using standard bond valuation methodology. A typical scenario involves a consumer inputting a plurality of mortgages and associated features (e.g., term of loan or type of interest rate) and receiving the option adjusted spread and risk measure for each mortgage, from which the consumer may select the appropriate mortgage having the lowest option adjusted spread within his or her risk tolerance. These steps can be implemented by a computer which includes a central processing unit (CPU) and a computer code operatively associated with the CPU. The relative option adjusted spreads and risk measures of various debt instruments can be displayed on a visual display or used to automatically commence the financing of a mortgage.

Owner:ICE DATA SERVICES INC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com