Method, system and program for credit risk management utilizing credit exposure

a credit exposure and risk management technology, applied in the field of methods, systems and programs for credit risk management, can solve the problems of increasing scrutiny and disclosure, energy companies are reeling from corporate scandals, and no current solution provides an effective method for tracking and analysing credit exposur

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

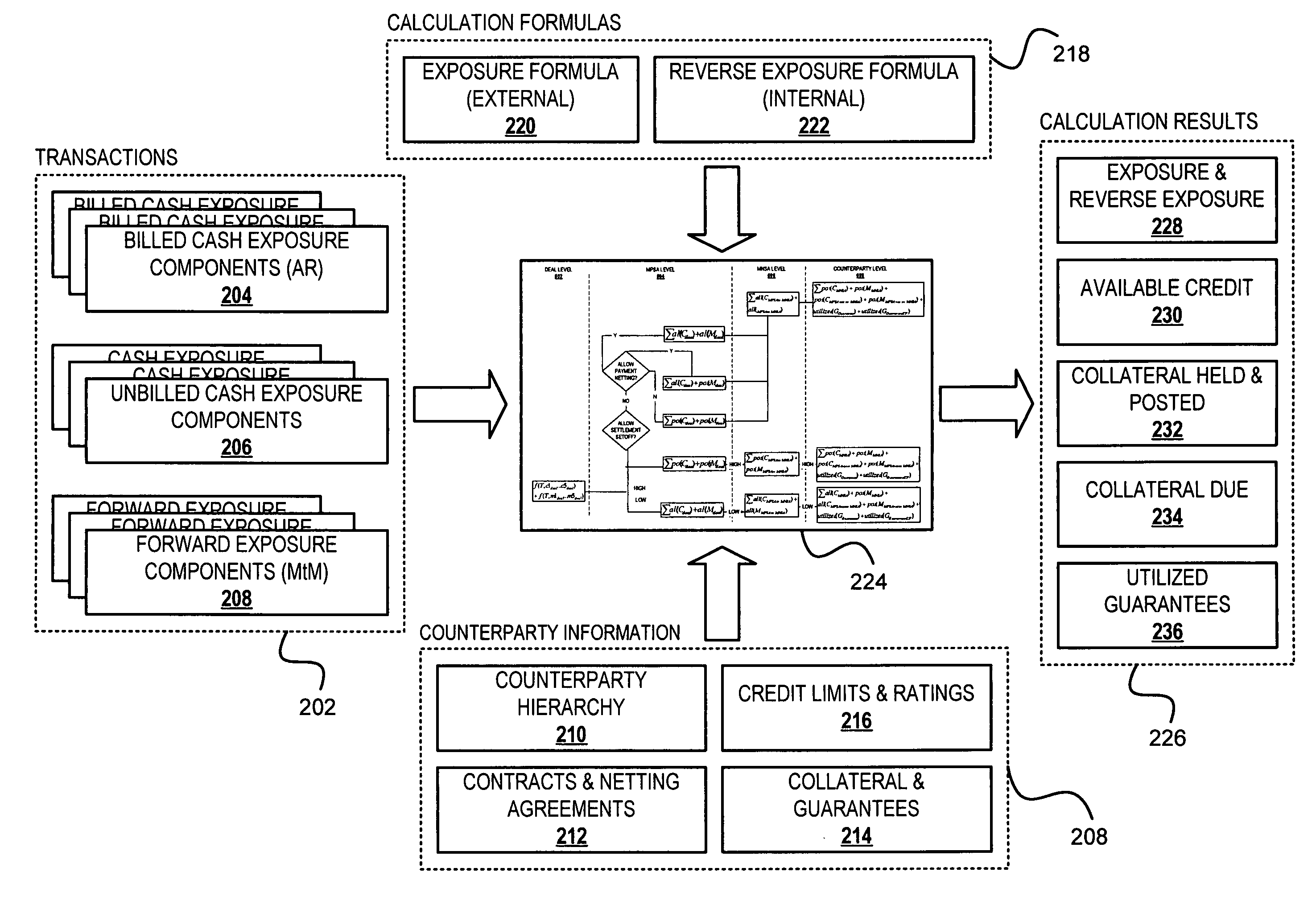

[0022] With reference now to FIG. 1, there is depicted a conceptual diagram of a software architecture in which a preferred embodiment of the prevent invention may be implemented. The software system 100 comprises application layers or objects, including presentation layer components 102, application business services 104, platform services 106 and data services 108 connected by a communication link 110. Each of the application layers 102-108 communicate with various other business applications 112 utilized within a line of business of an enterprise and a database 114 for storage of application data. Line of business applications 112 may be accounting software, trading software and other risk management applications, for example. Presentation layers 102-108 communicate over link 110. Presentation layers 102-108 also communicate with line-of-business applications 112 and universal database 114 over link 110 for storing and retrieving data accessed and generated by the software system...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com