Patents

Literature

257 results about "Counterparty" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A counterparty (sometimes contraparty) is a legal entity, unincorporated entity, or collection of entities to which an exposure to financial risk might exist. The word became widely used in the 1980s, particularly at the time of the Basel I in 1988.

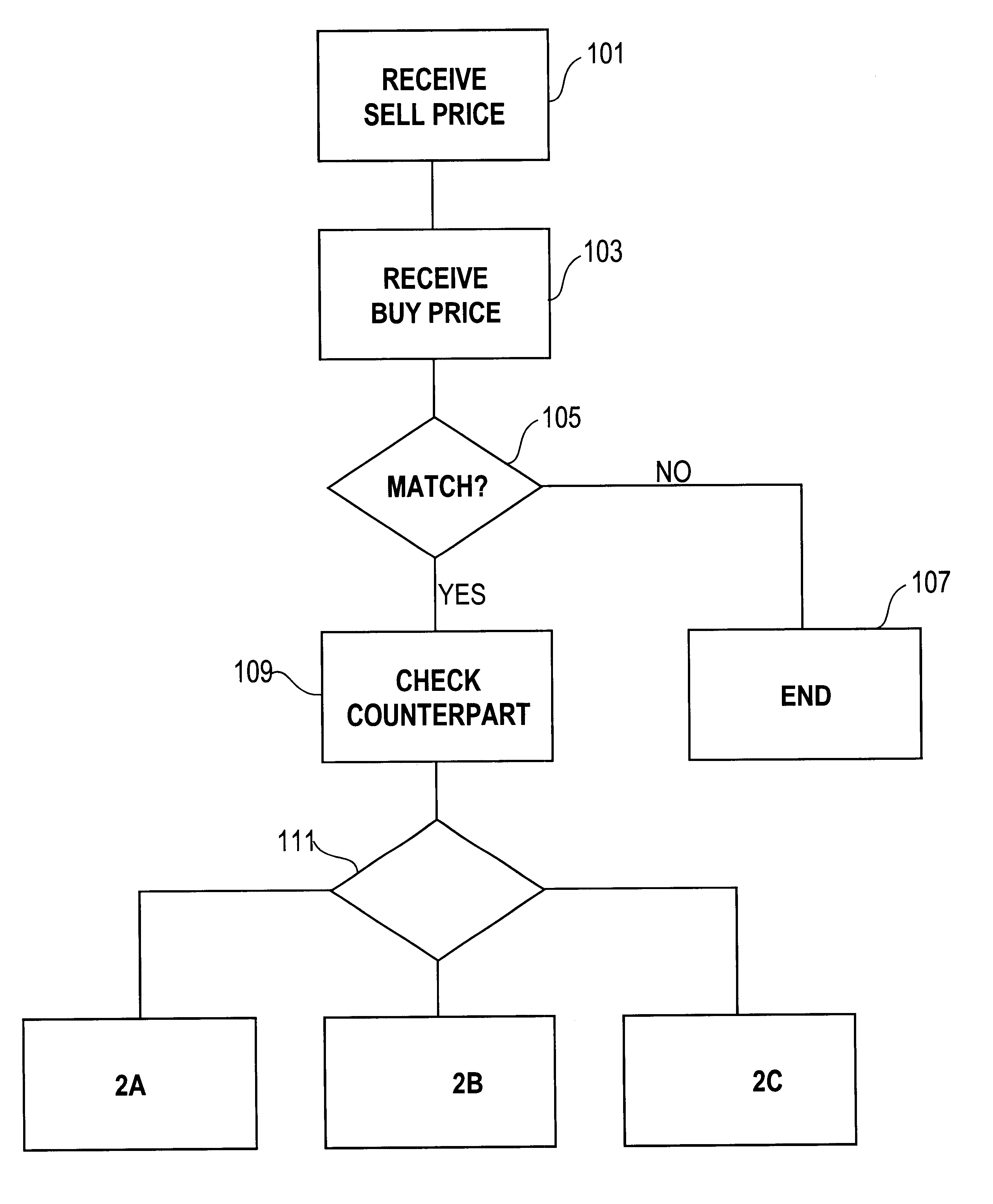

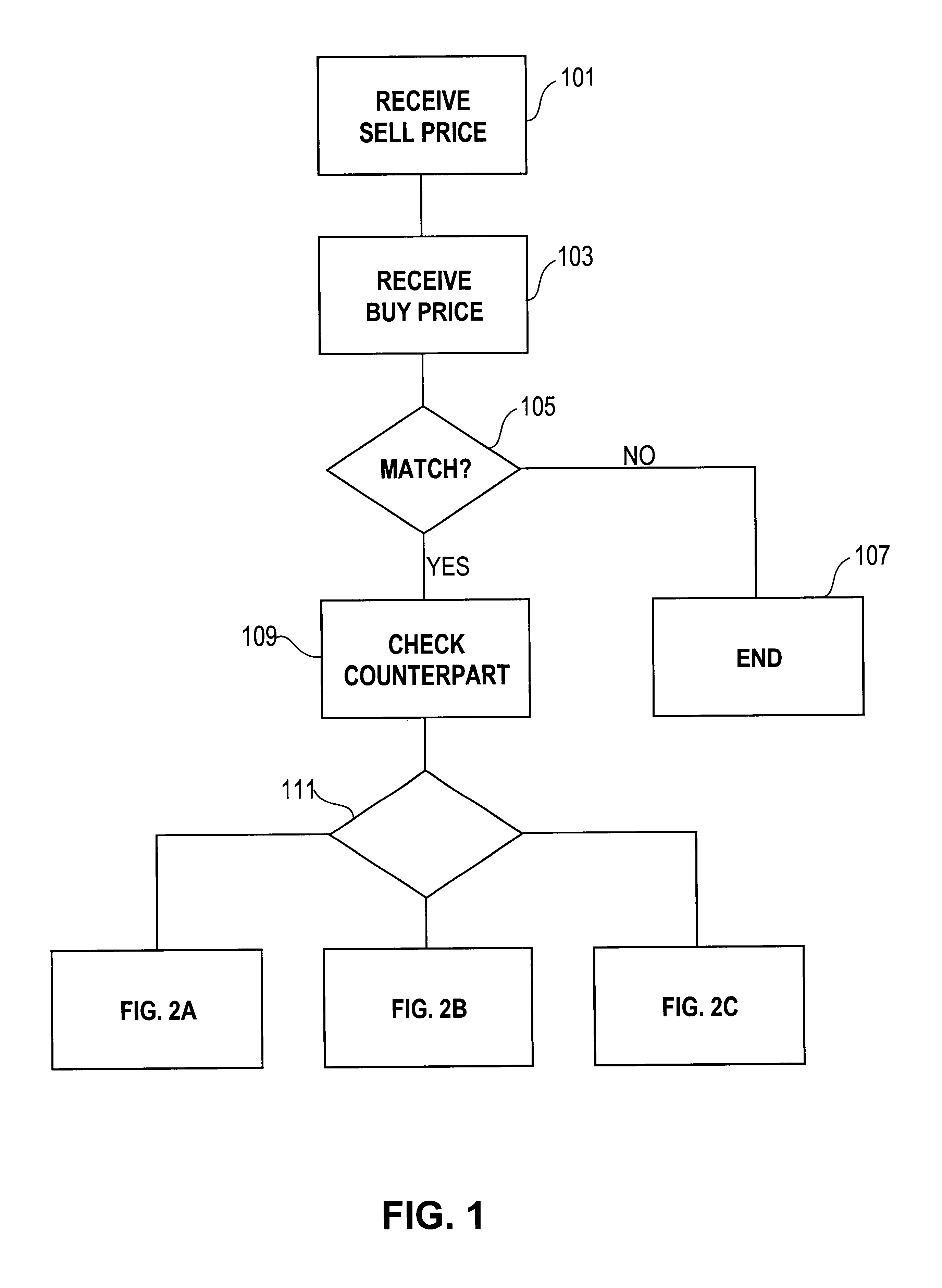

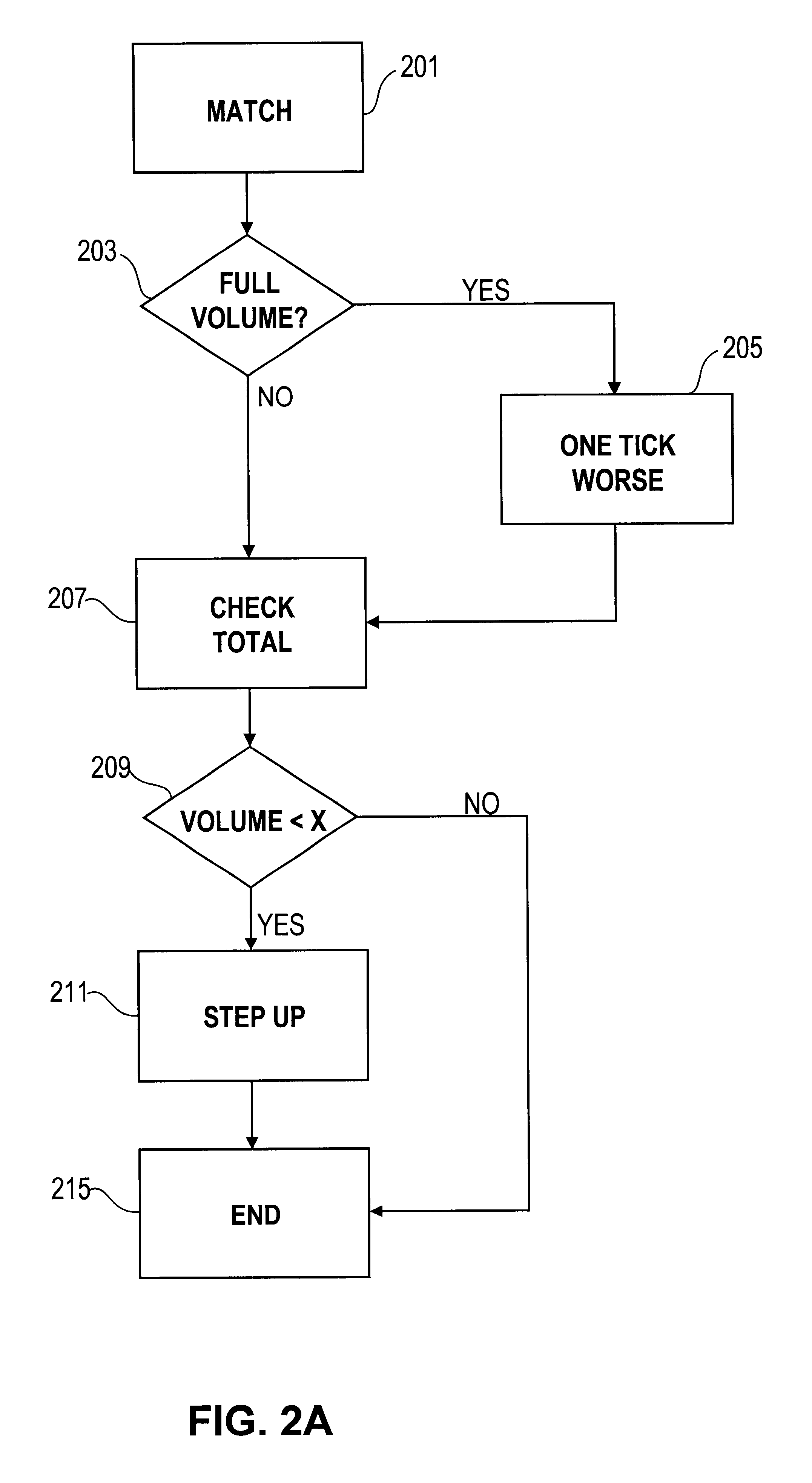

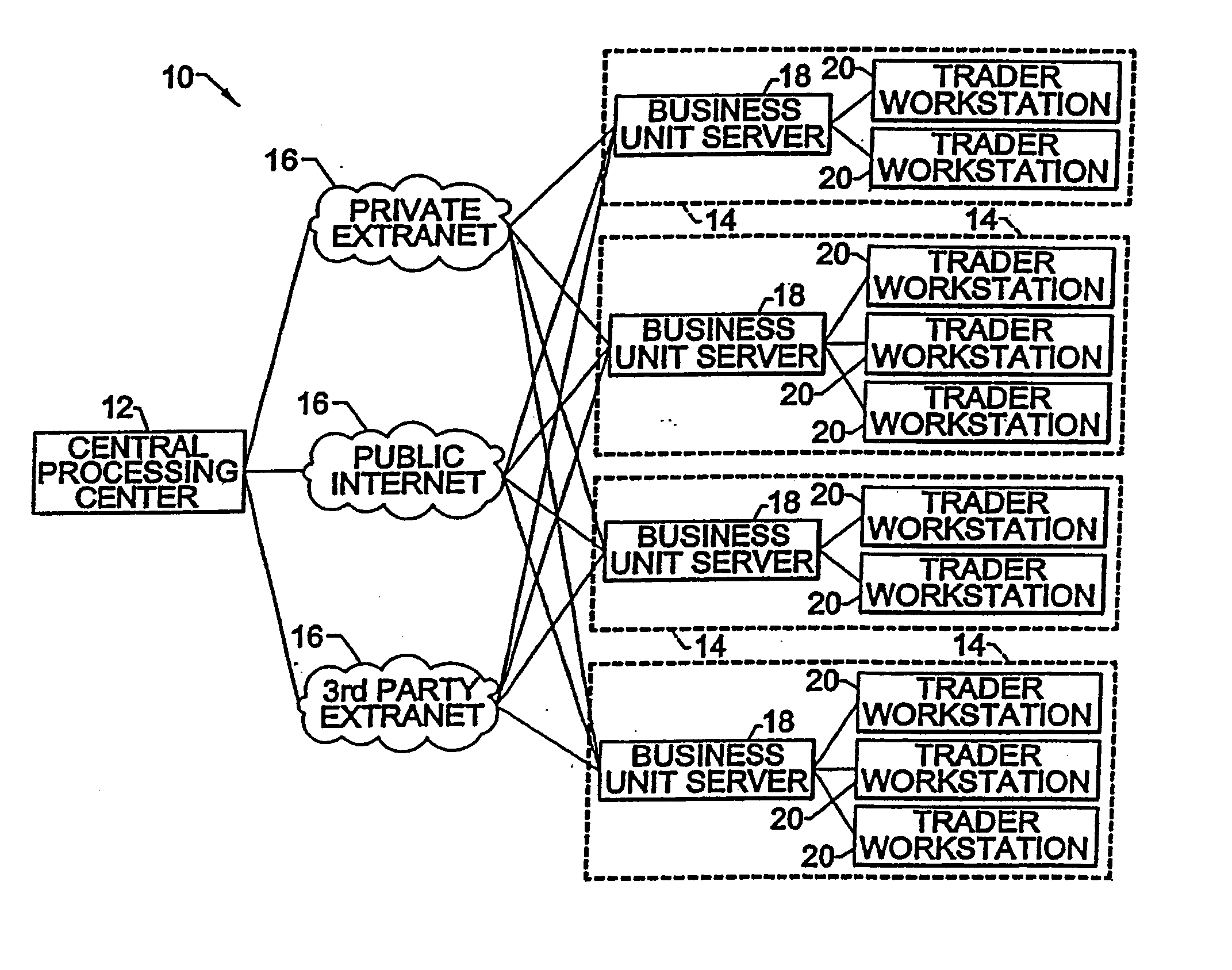

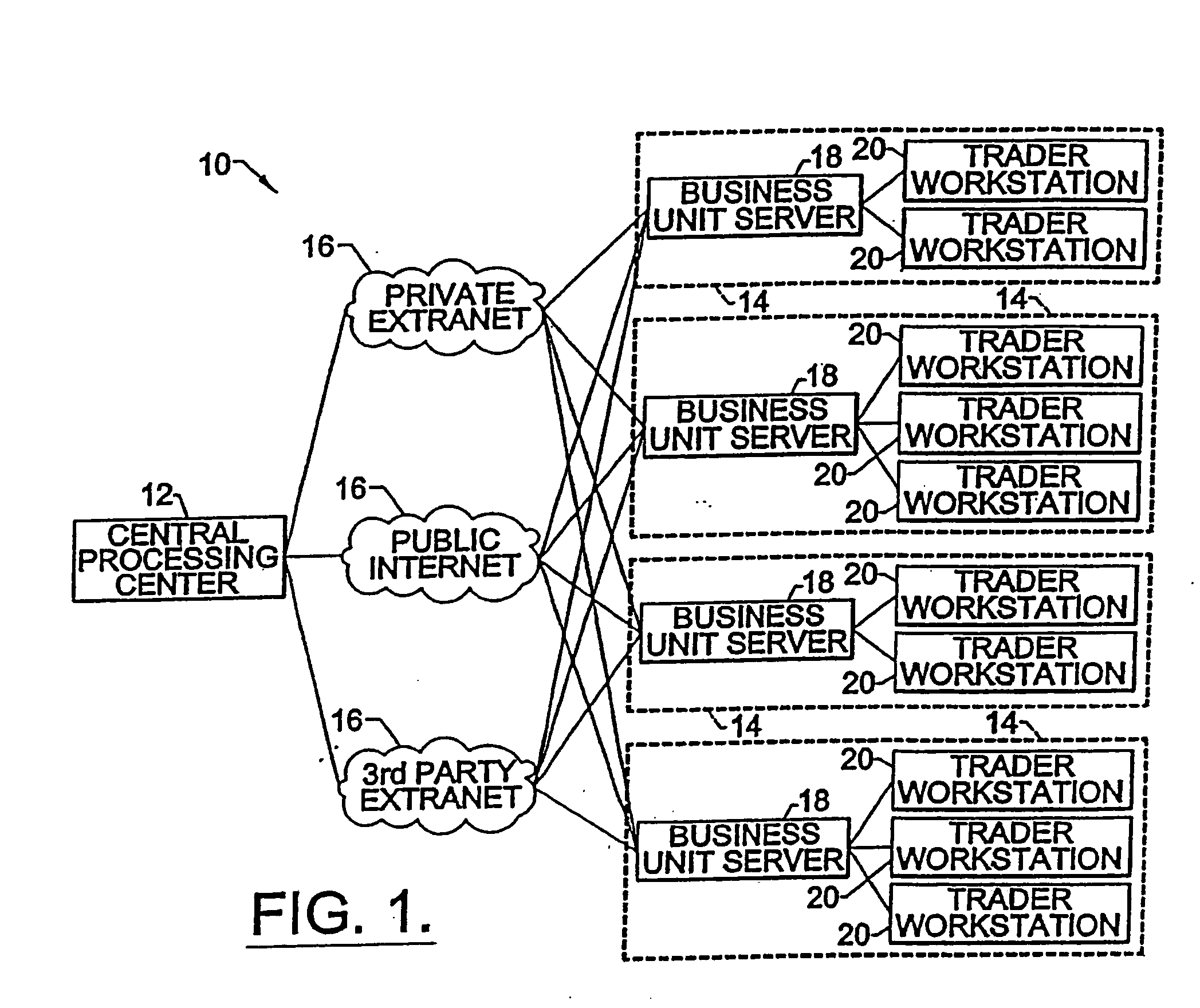

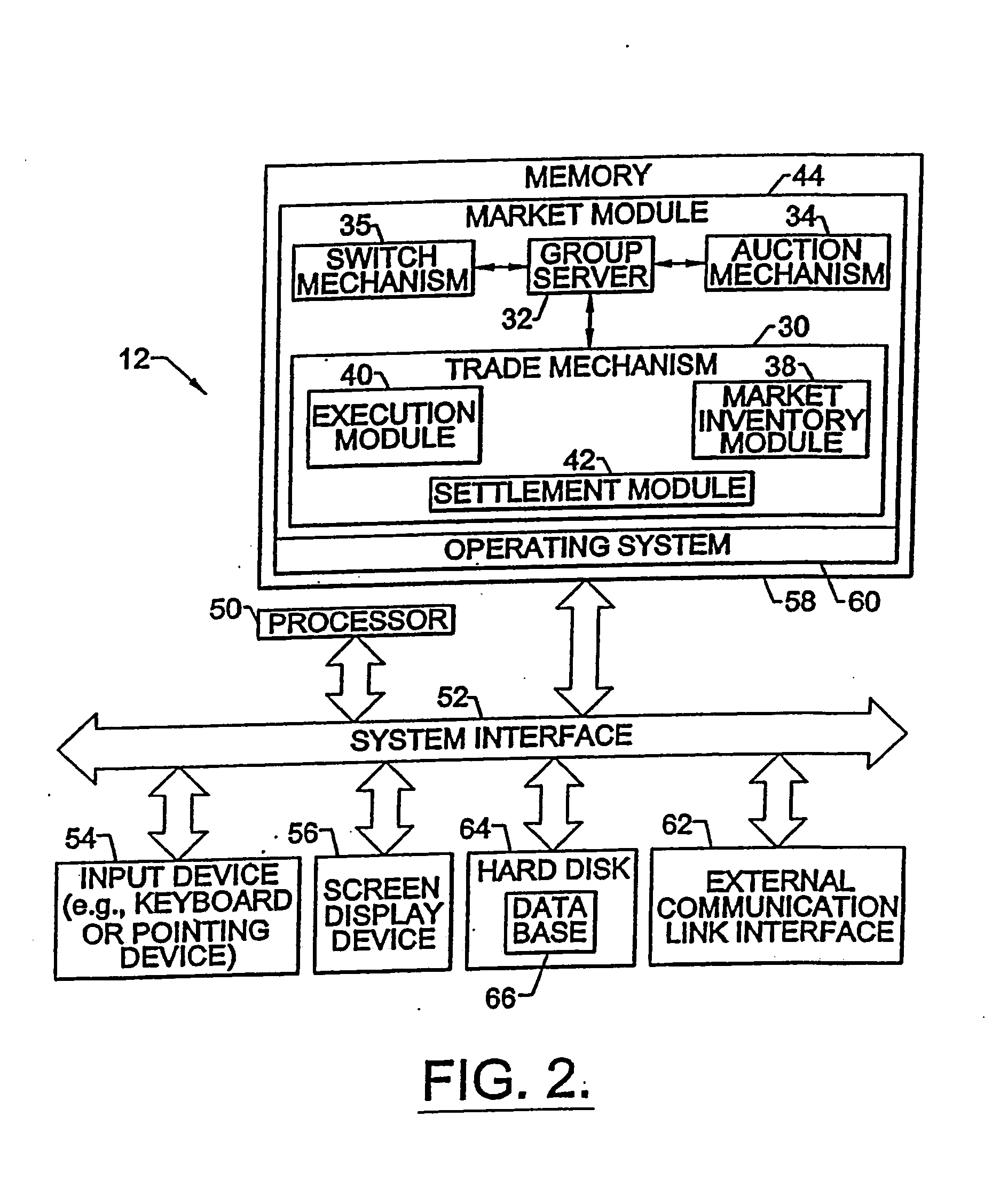

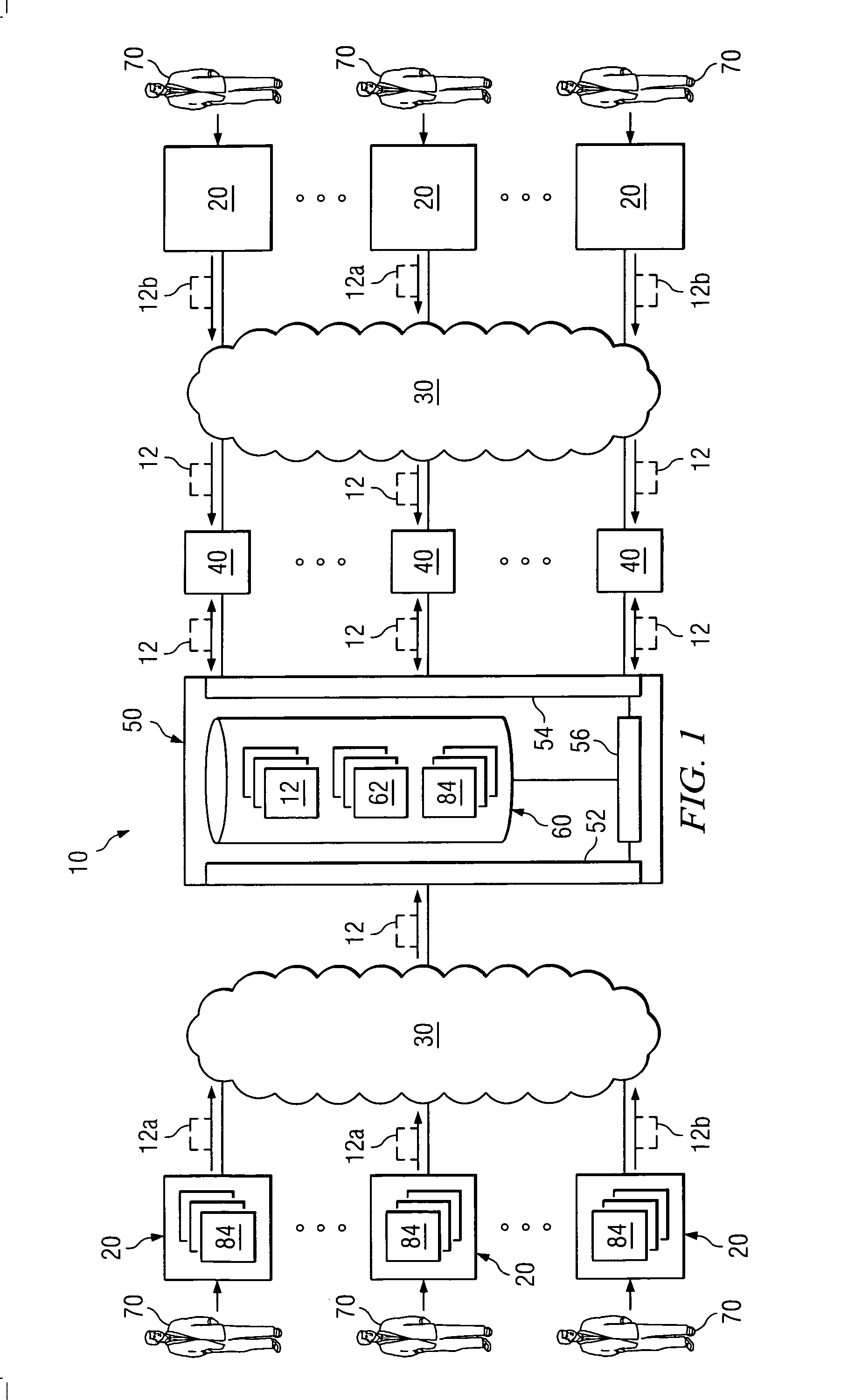

Automated exchange for matching bids between a party and a counterparty based on a relationship between the counterparty and the exchange

InactiveUS6405180B2Tight spreadReduced volume (risk)Special service provision for substationFinanceOrder formCourse of action

In an automated exchange system means are provided by means of which a market maker can enter a course of action in advance, so that the volume in the orderbook is continuously updated, and where the updating is performed differently with respect to different counter parts. Also, quotes that may result in a trade between Market Makers are hidden for some time before being matched, thus giving the Market Makers a chance to back off. The system employs a function that supports that Market Makers through pre-defined parameters will have new orders generated by the system and that a market maker can act differently with respect to different counterparts. The parameters specify if a Market Maker should add extra volume on an existing price or generate a new order at a worse price. In order to make it possible for market makers to have a very tight spread without forcing them to take larger risks, additional logic is used when matching orders. The algorithm used for this purpose protects the market makers in certain situations and gives market makers the possibility to have a tight spread without taking a large risk. The algorithm also supports that the market makers can take the risk to quote large volumes.

Owner:ISE LLC

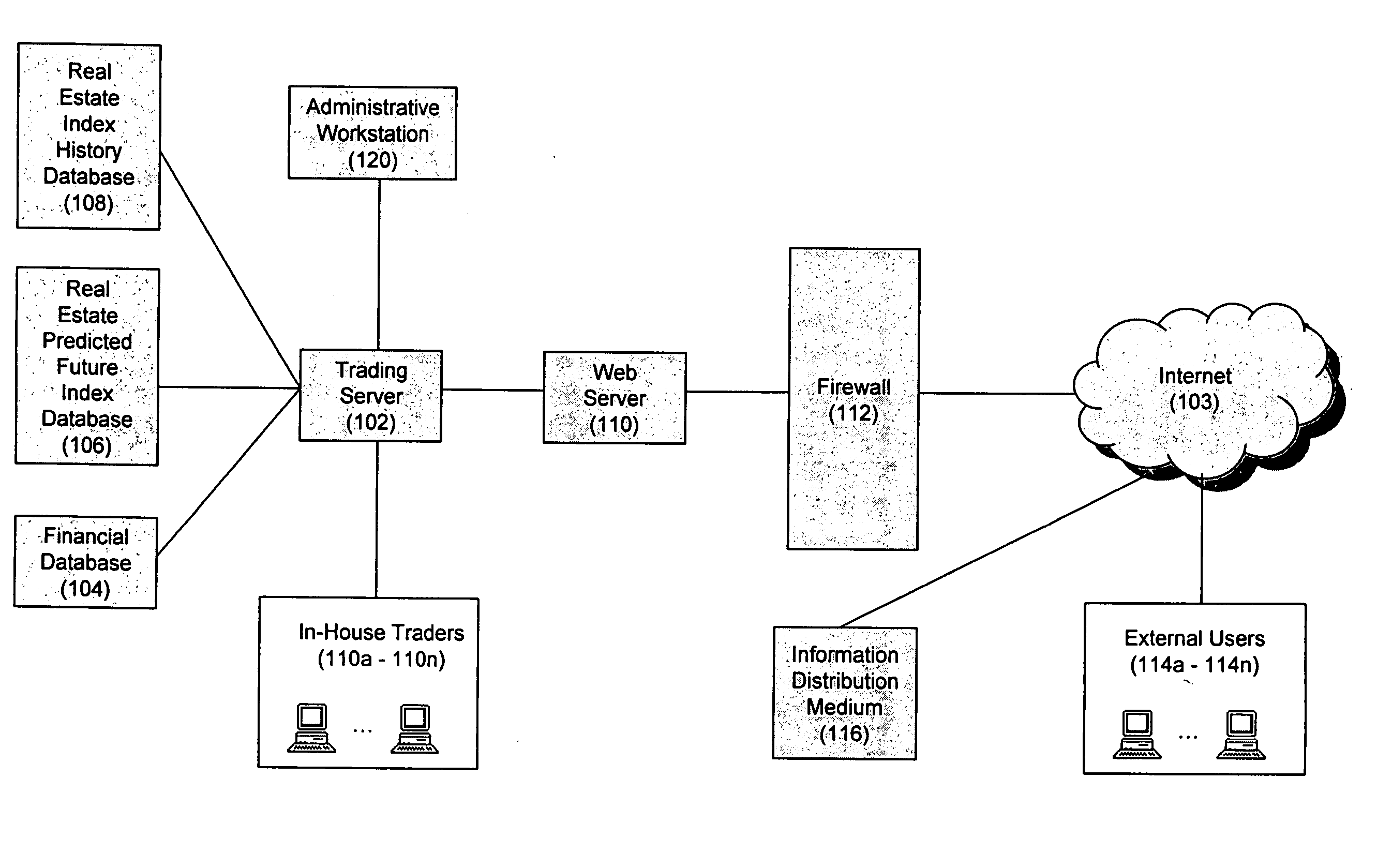

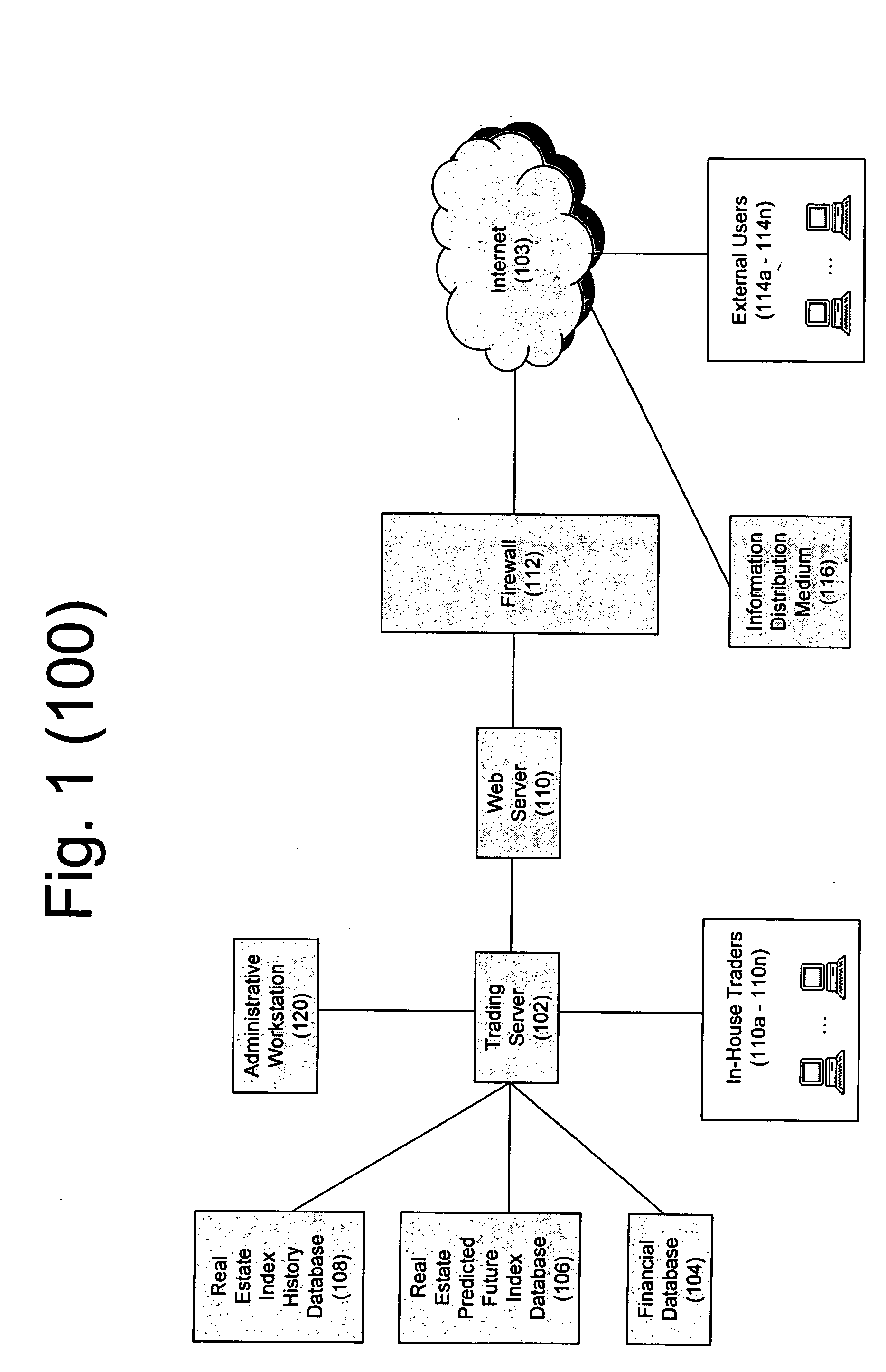

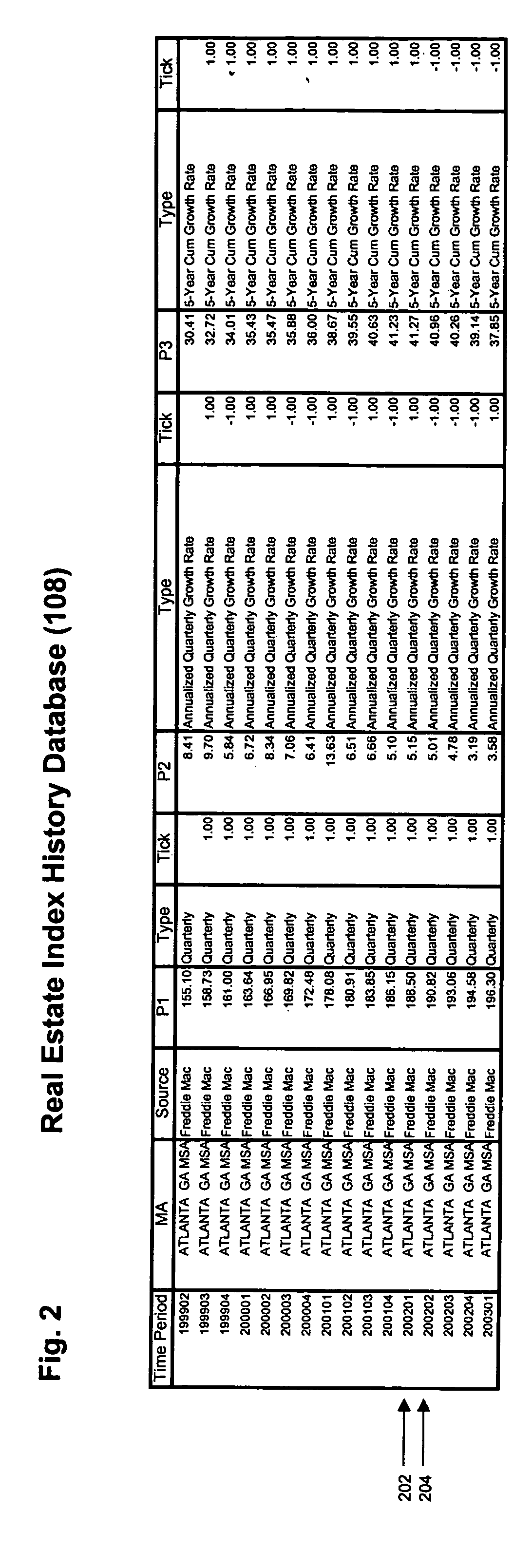

System, method, and computer program for creating and valuing financial instruments linked to real estate indices

InactiveUS20050216384A1Easy to implementFinanceSpecial data processing applicationsData miningCounterparty

A system, method and computer program for creating and valuing financial instruments (including but not limited to futures, forwards, call options, put options, swaps, “swaptions”, and “op-swaps”) linked to published real estate indices. The present invention will be referred to in this application as a real estate index linked financial instrument, and is defined as a financial instrument whose value changes based on movements in underlying indices based on real estate prices. These indices are published by sovereign governments, government-chartered agencies and departments (such as Fannie Mae, Freddie Mac, Office of Management and Budget, and the Treasury Department in the U.S.), non-governmental organizations, commercial banks, investment banks, realty agencies and many other organizations. The instruments can be written, with a published index number from any real estate index or indices as the initial value upon which the financial instrument's terms are based. The predicted future value of the real estate index or indices will change in response to market buy / sell demand based on investor expectations of the predicted future value of the real estate index or indices related to one or more real estate index linked financial instrument(s). Thus, the predicted future value of the index or indices will change in response to the market demand as investors offer to buy and / or sell real estate index linked financial instruments which will be listed on securities exchanges and electronic commerce networks (ECNs) as well as over the counter (OTC) and in private transactions. Each predicted future index value will change based on the investor expectation of how strong demand will be for the underlying real estate market upon which each index or indices are based. Thus, the present invention gives investors a means of taking or adjusting positions upon price movements in local, city, regional, state, national, or multinational / international real estate markets. It is important to note that real estate index linked financial instruments can be created either in standardized contract sizes that can be traded on futures, options or other securities exchanges, ECNs and / or OTC, or can be customized to meet the specifications of a transactional counterparty which wishes to speculate on movements in local, city, regional, state, national, or multinational / international real estate prices. Such instruments may also be created from a plurality of indices, thus allowing an investor to package movements from several different real estate indices into a single financial instrument. Such instruments may also involve a combination of real estate index linked financial instruments, either with each other or with other financial instruments in a combination containing at least one real estate index linked financial instrument.

Owner:WORLD RISK GRP

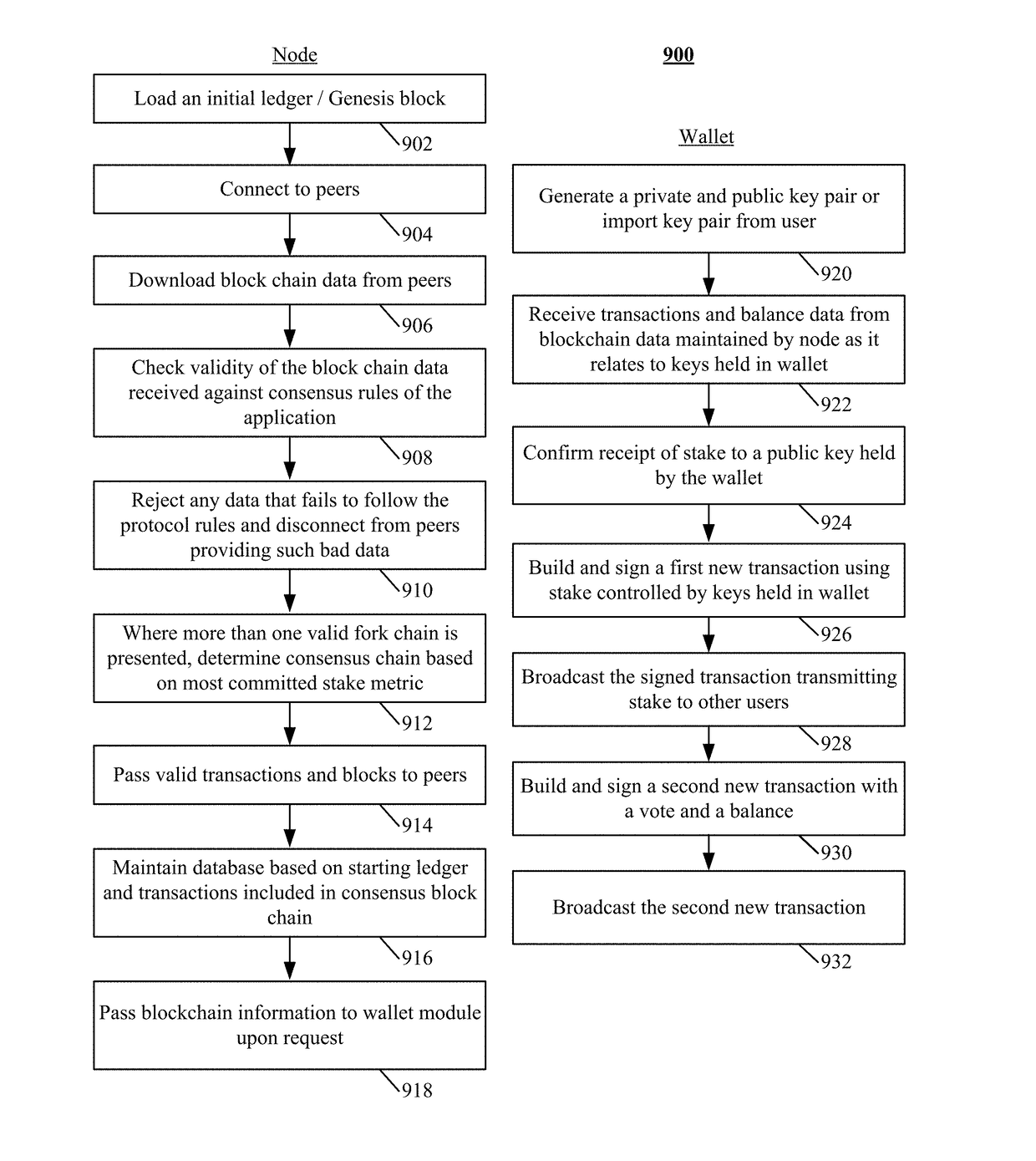

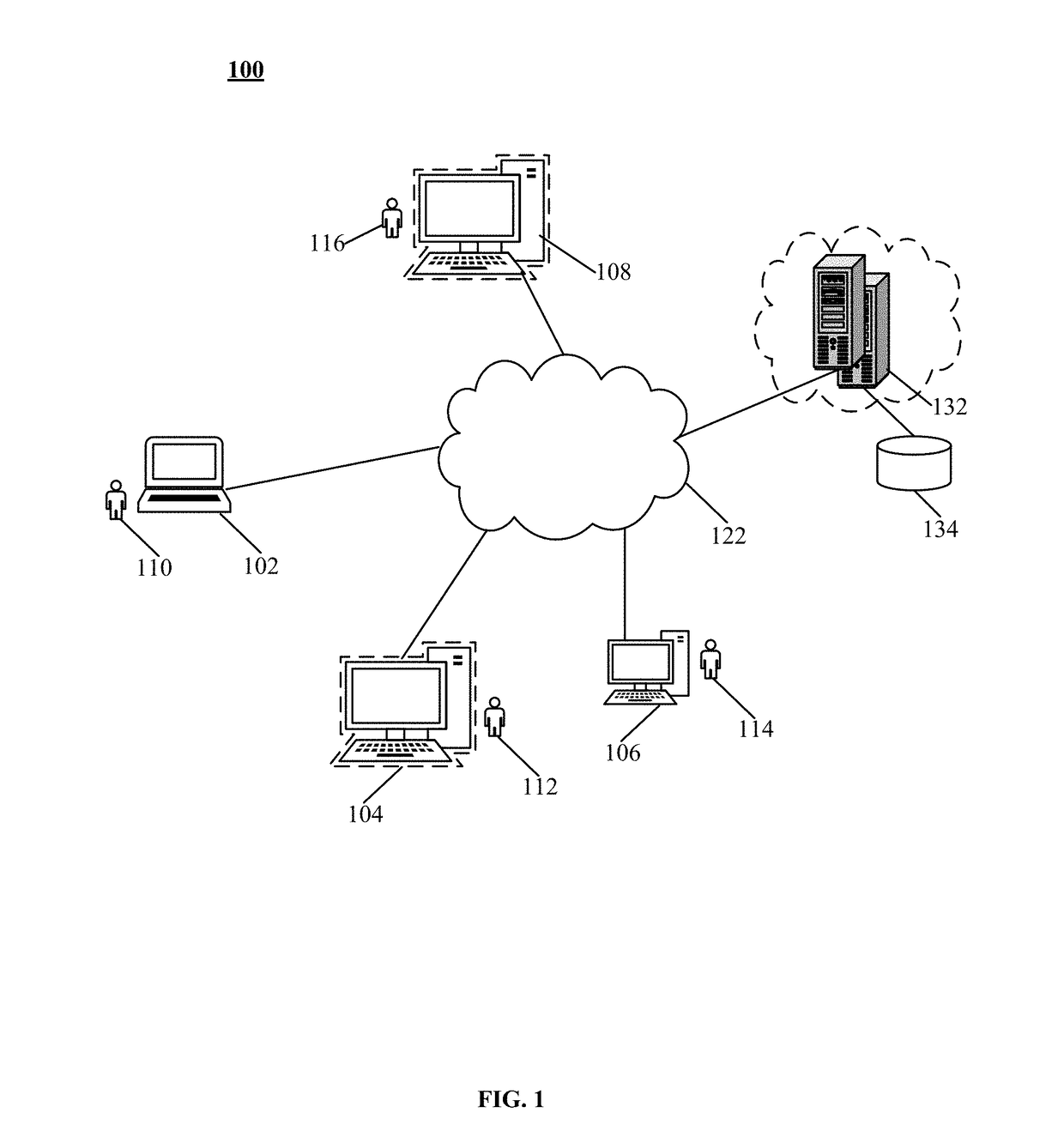

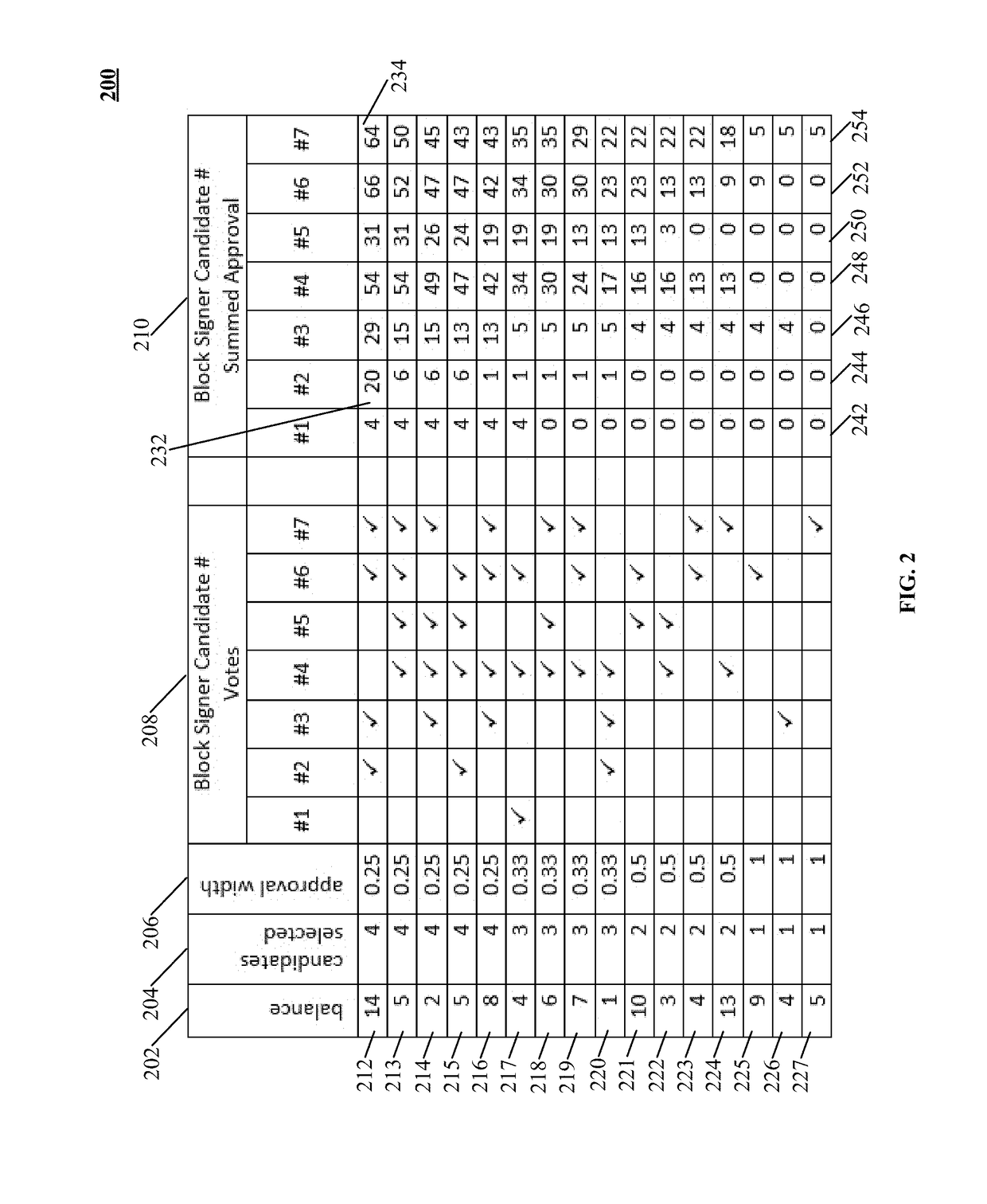

Consensus system for tracking peer-to-peer digital records

ActiveUS9875510B1Improve trustReduce overheadComplete banking machinesFinanceDigital recordingData Corruption

The disclosure describes a peer-to-peer consensus system and method for achieving consensus in tracking transferrable digital objects. The system achieves consensus on a shared ledger between a plurality of peers and prevents double spending in light of network latency, data corruption and intentional manipulation of the system. Consensus is achieved and double spending is prevented via the use of the most committed stake metric to choose a single consensus transaction record. A trustable record is also facilitated by allowing stakeholders to elect a set of trusted non-colluding parties to cooperatively add transactions to the consensus record. The voting mechanism is a real-time auditable stake weighted approval voting mechanism. This voting mechanism has far reaching applications such as vote directed capital and providing a trusted source for data input into a digital consensus system. The system further enables digital assets that track the value of conventional assets with low counterparty risk.

Owner:KASPER LANCE

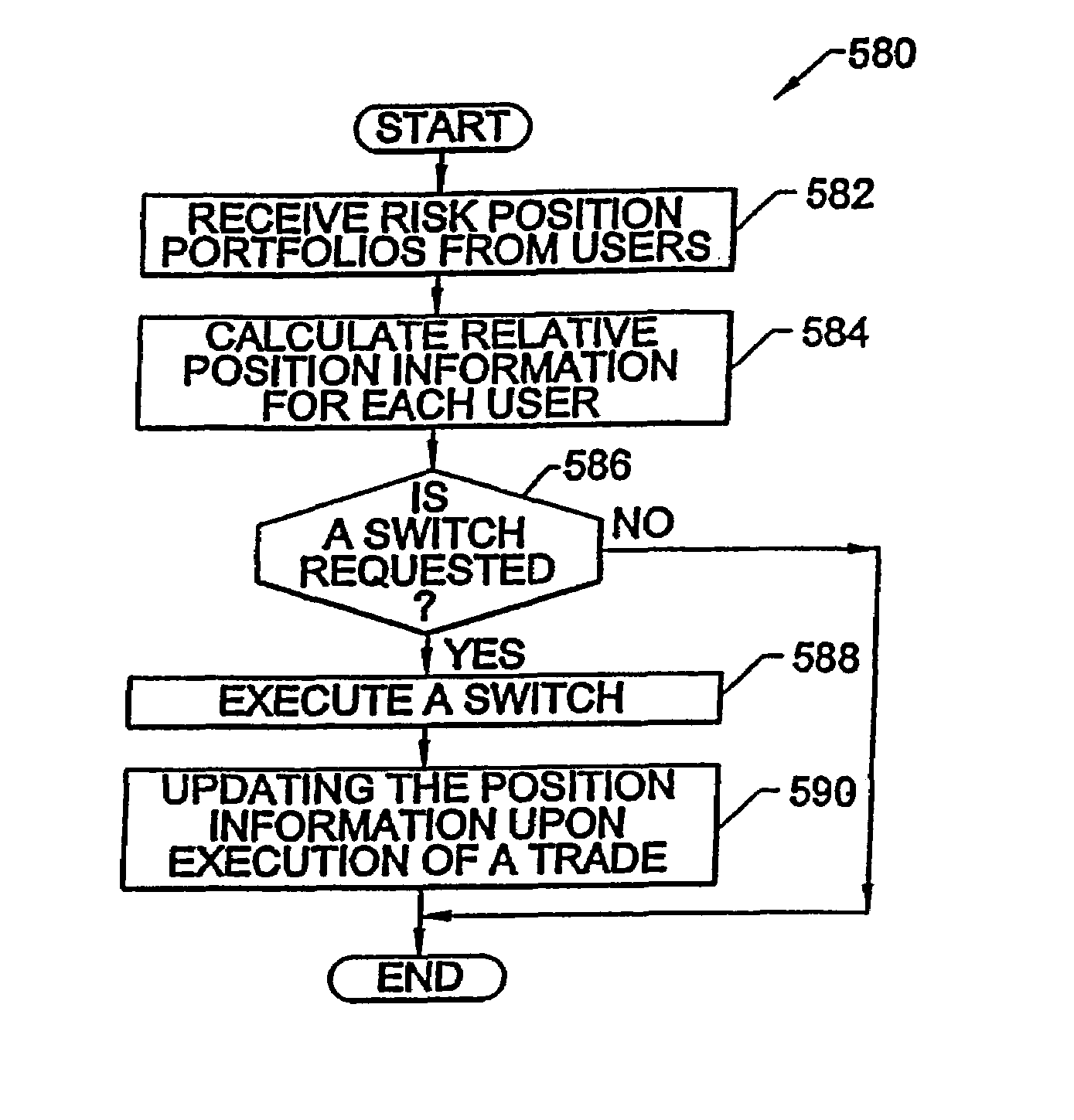

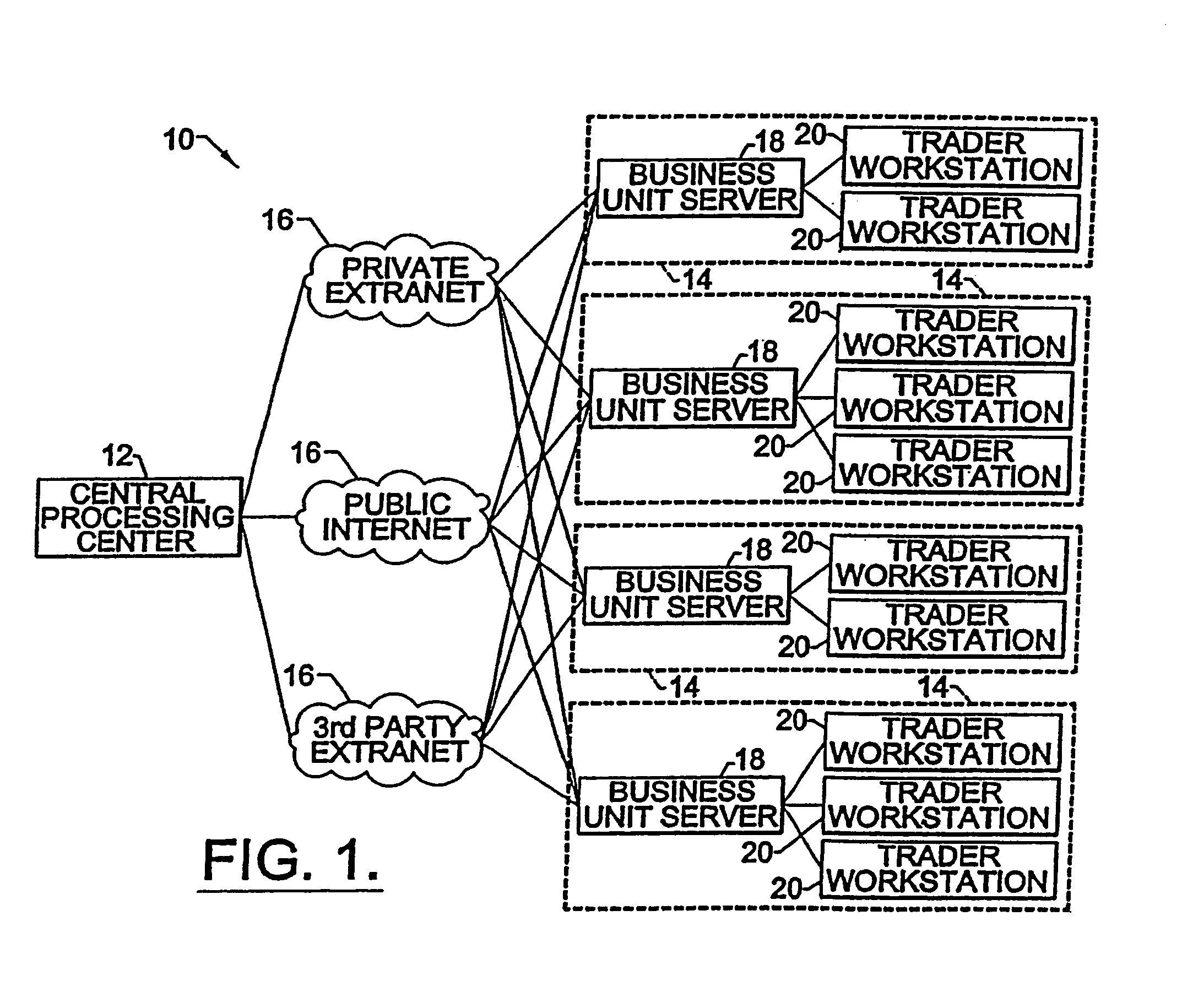

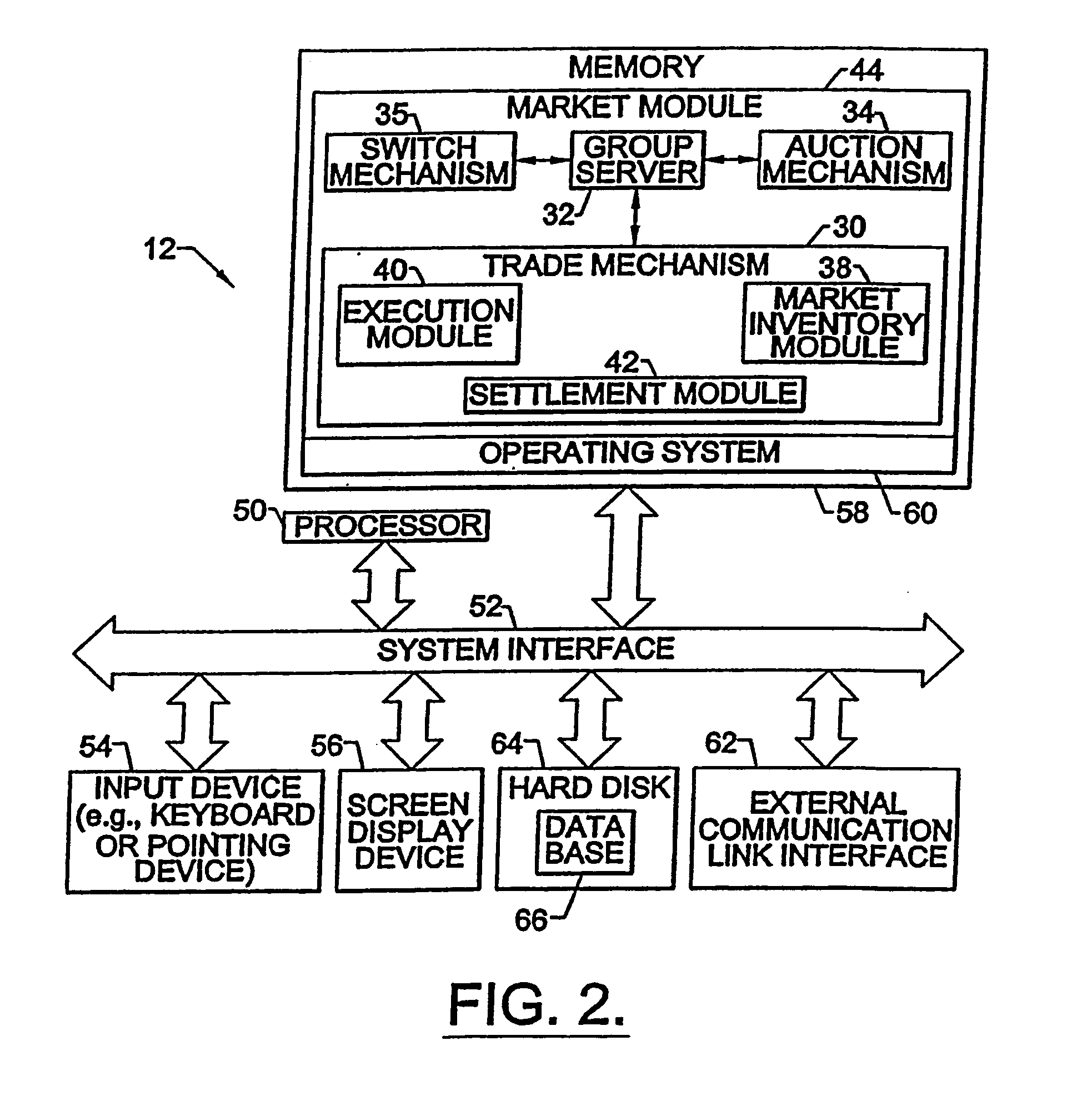

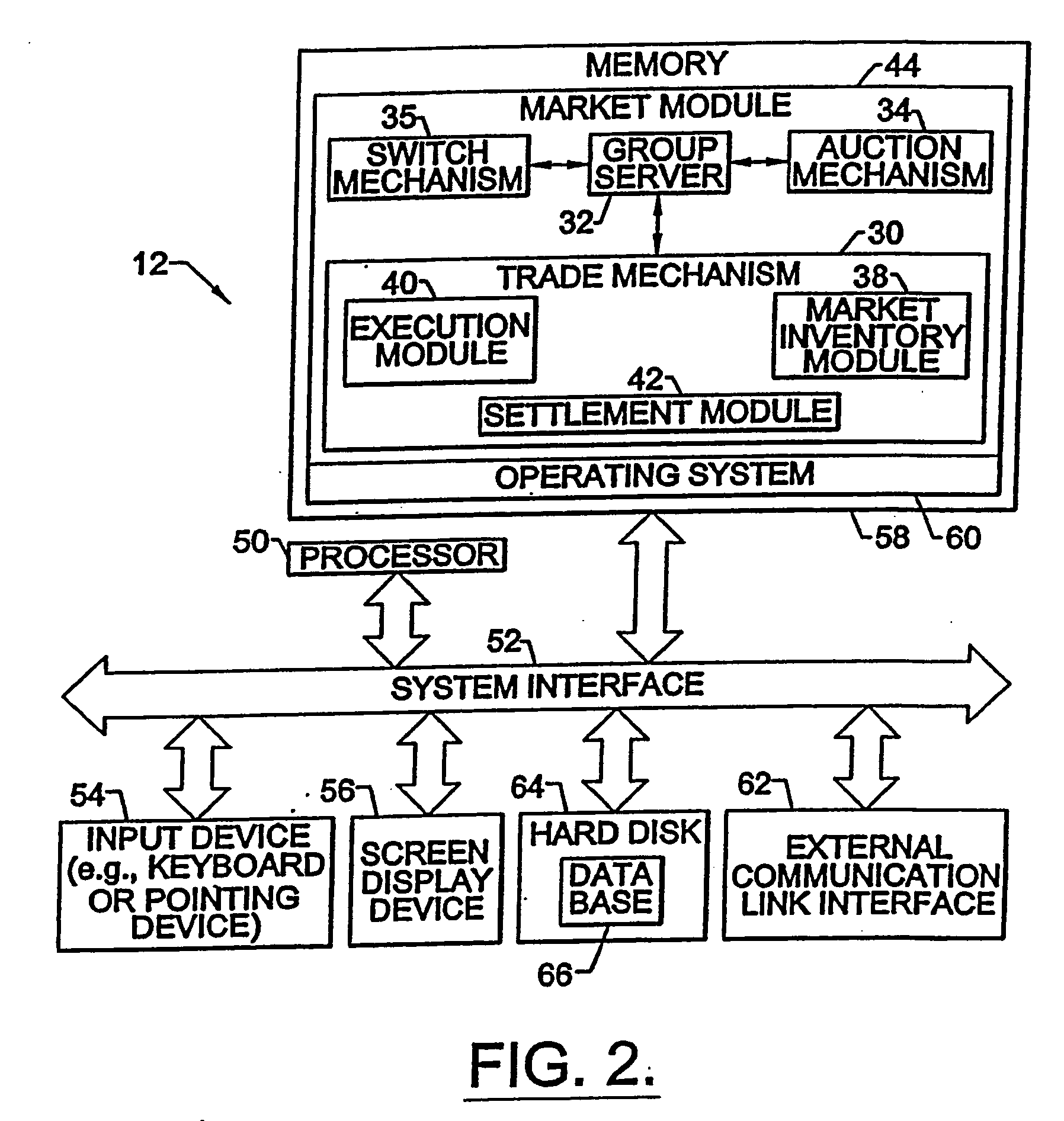

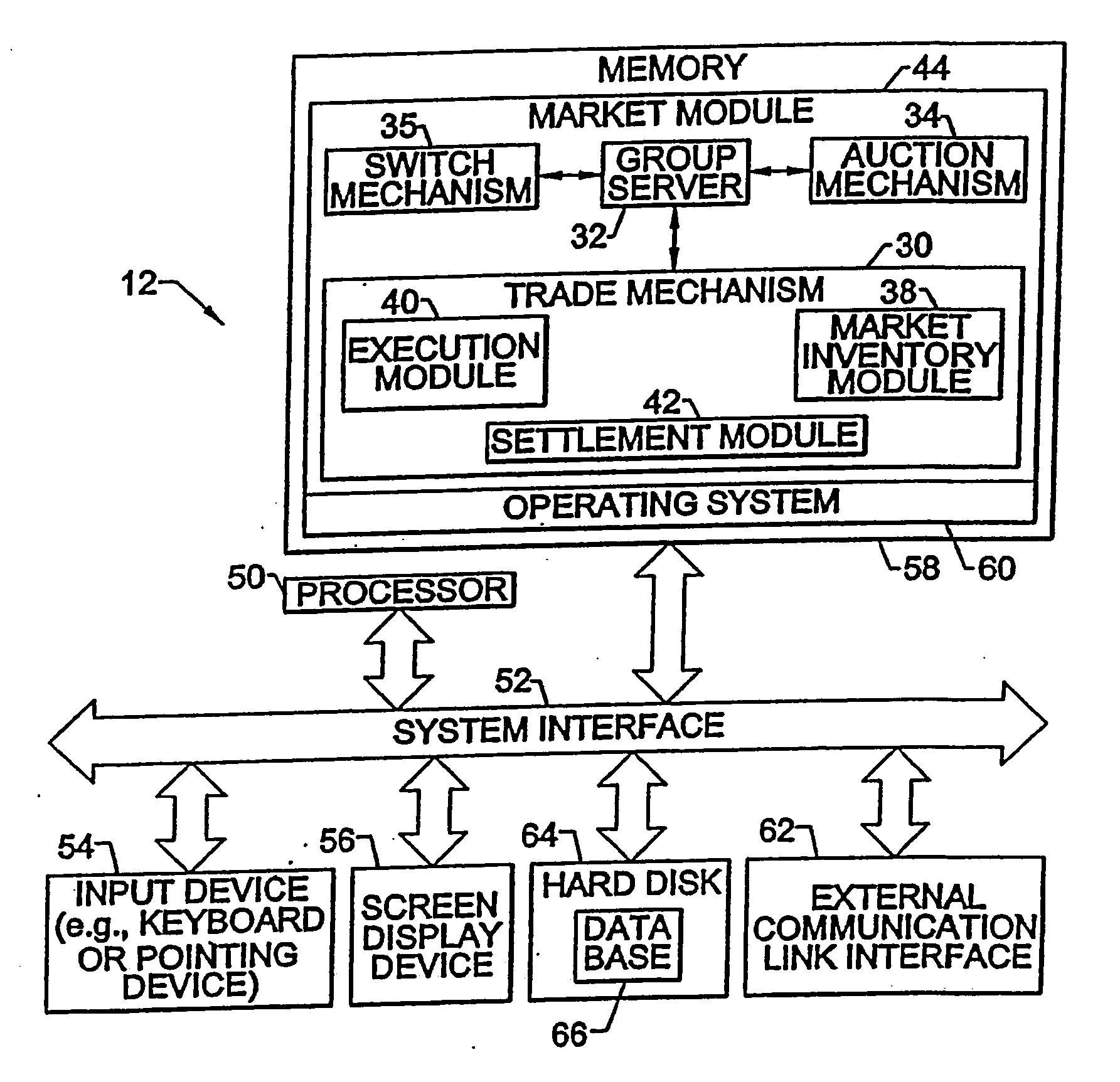

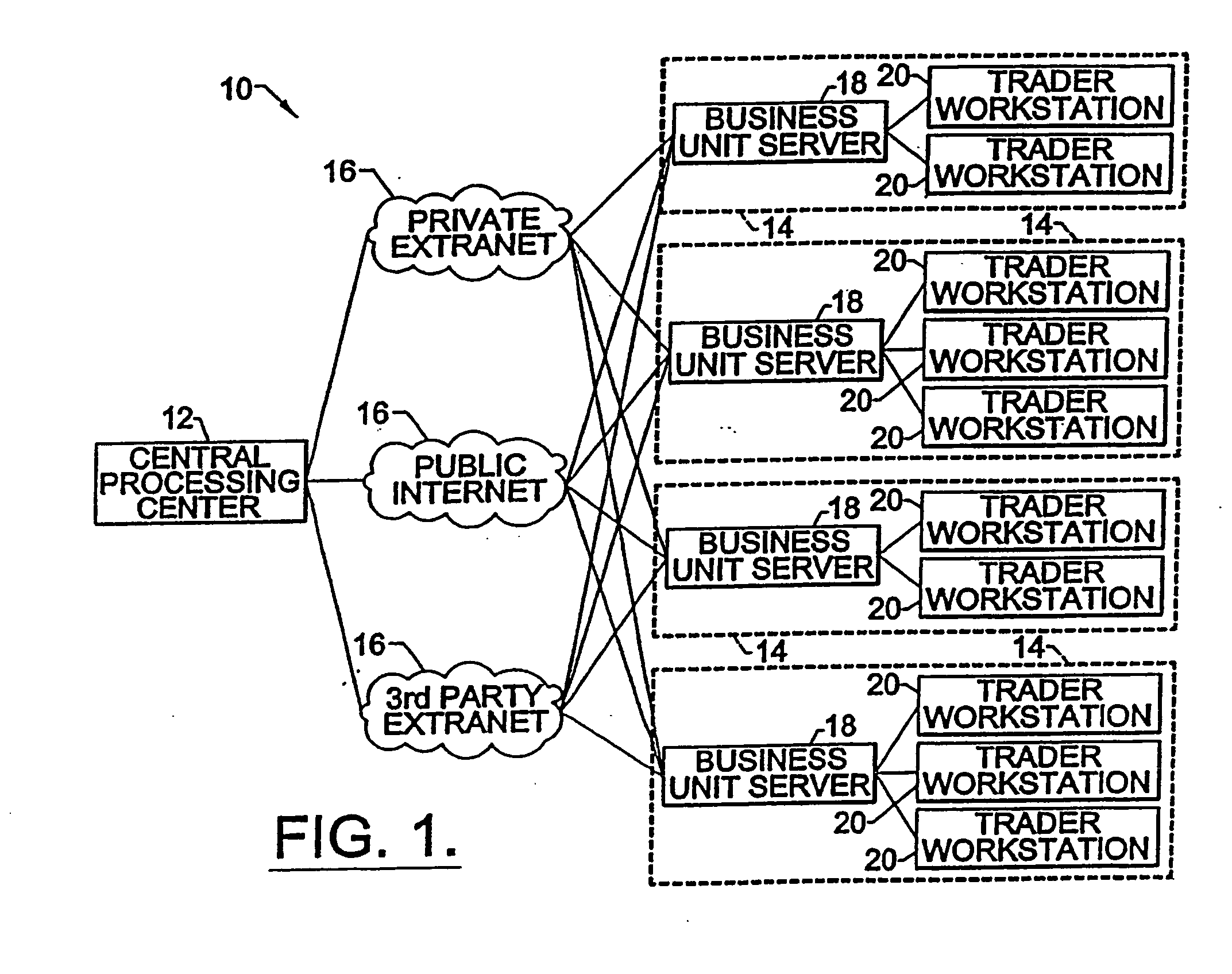

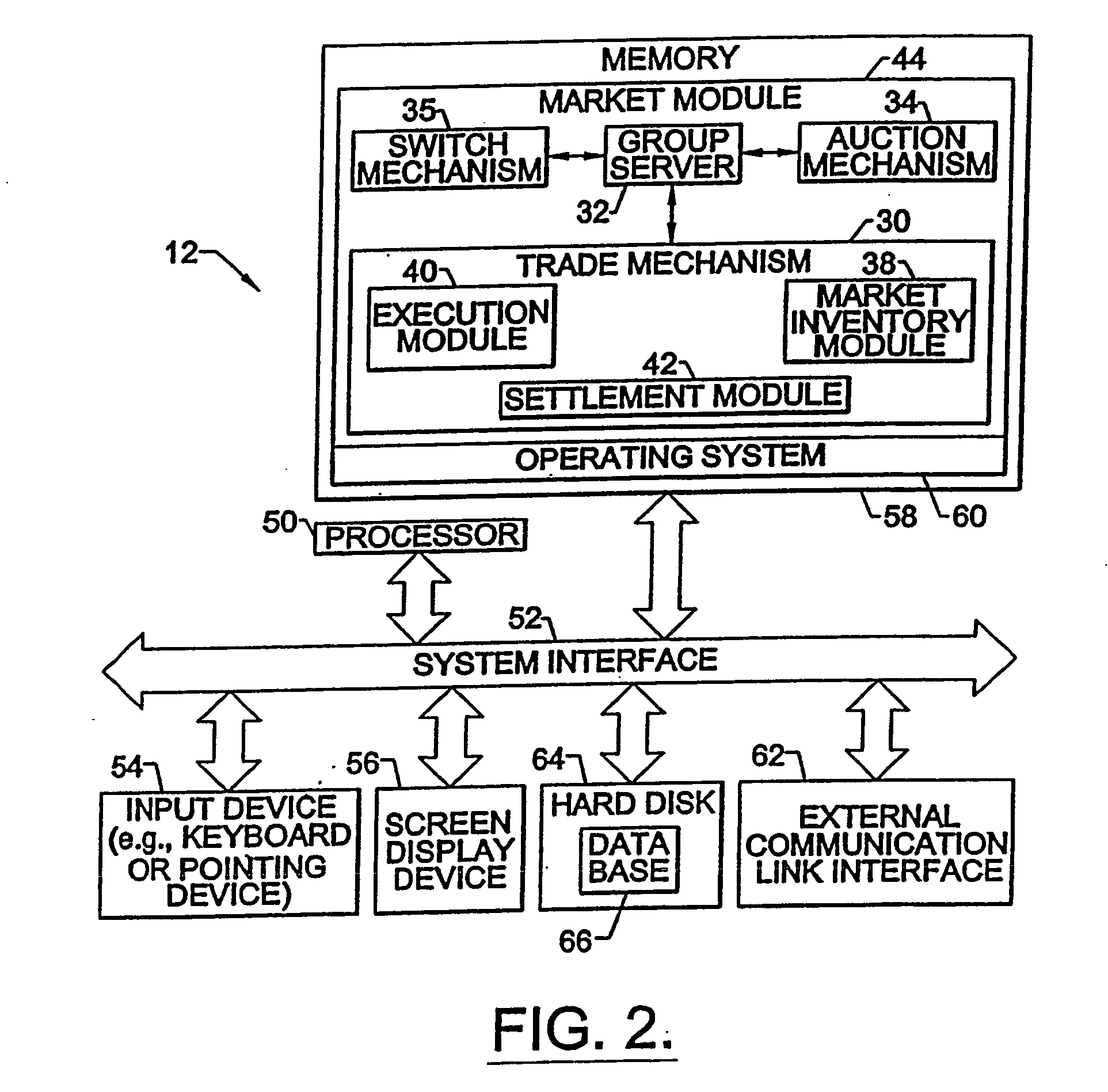

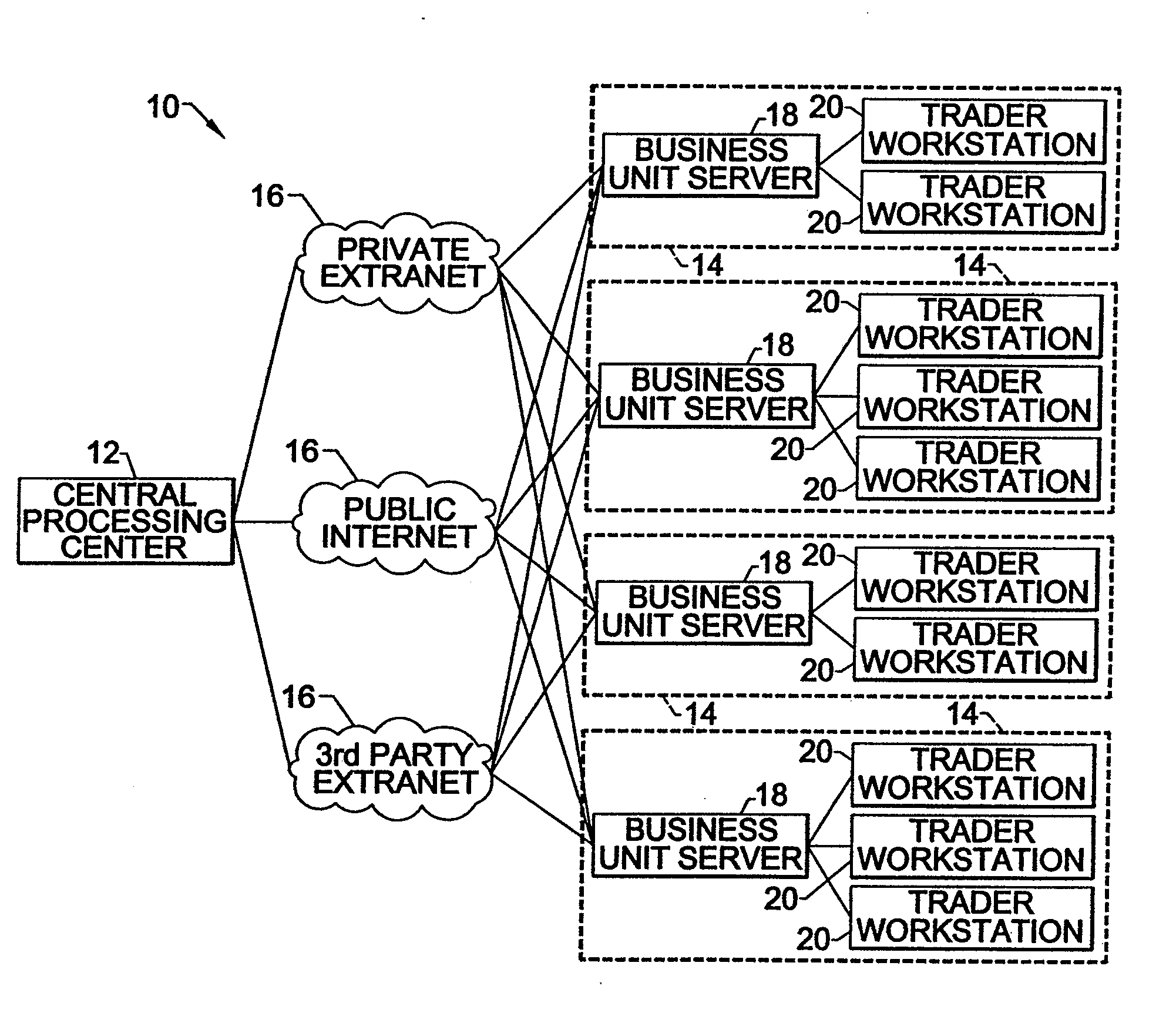

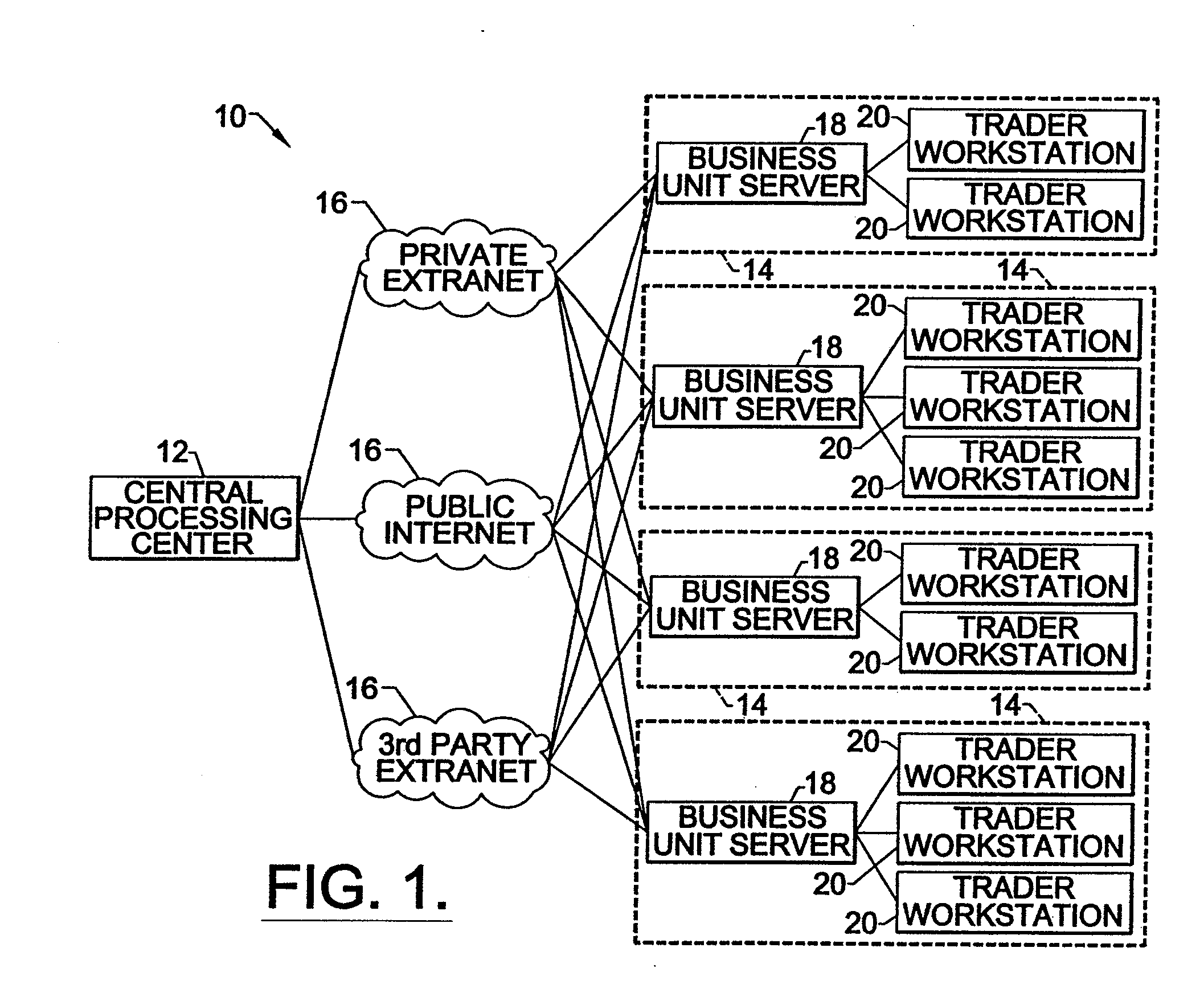

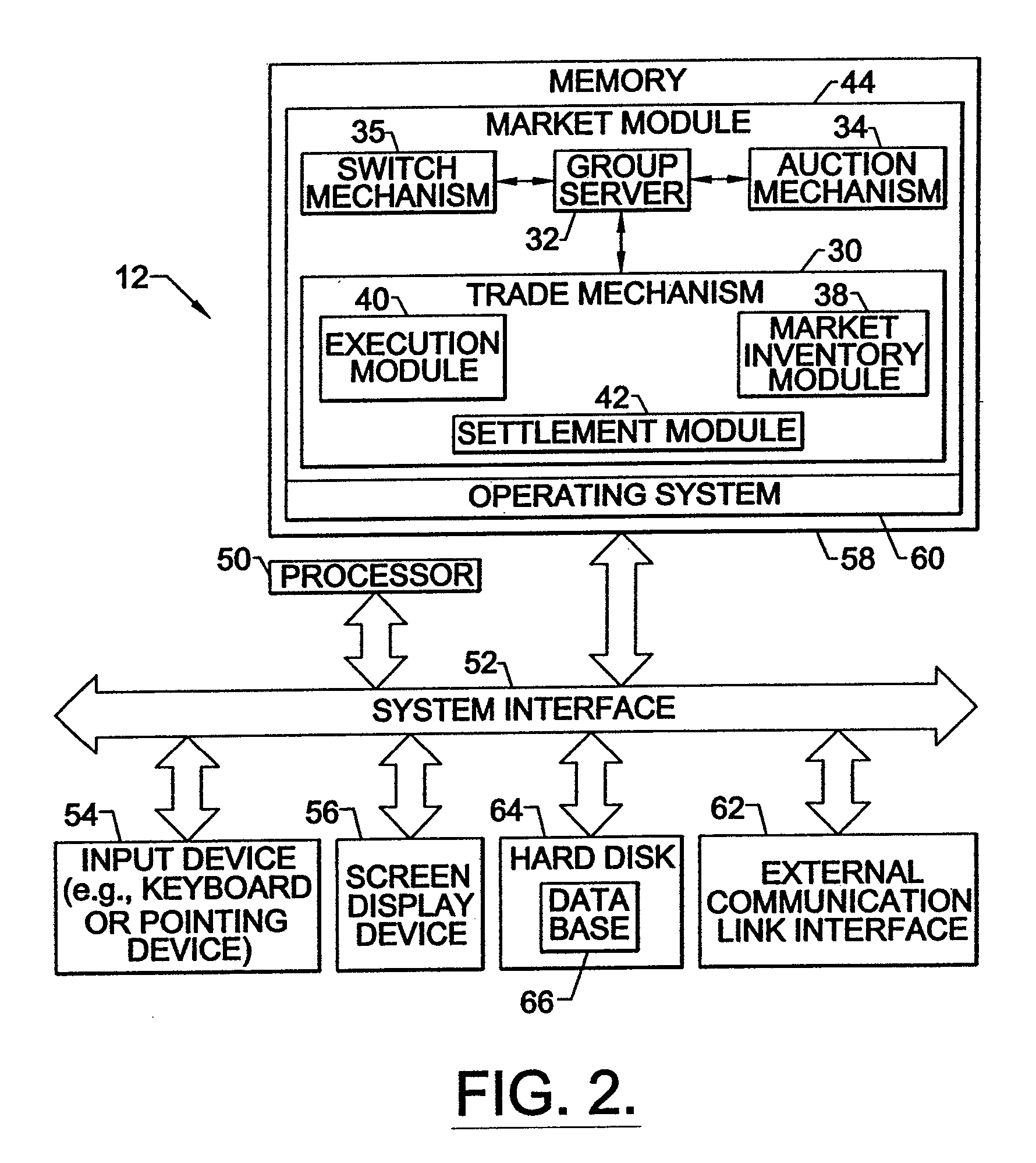

Systems for switch auctions utilizing risk position portfolios of a plurality of traders

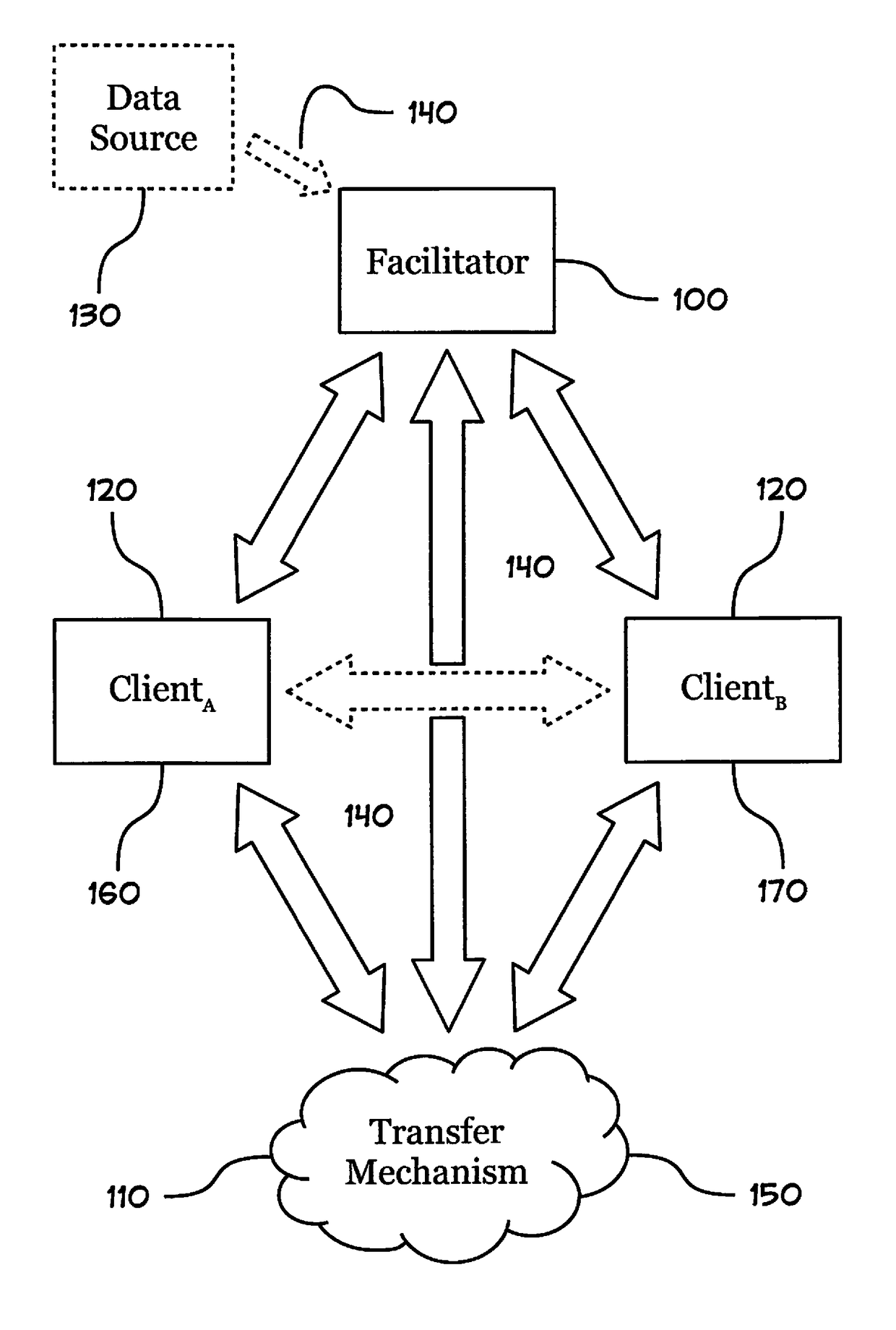

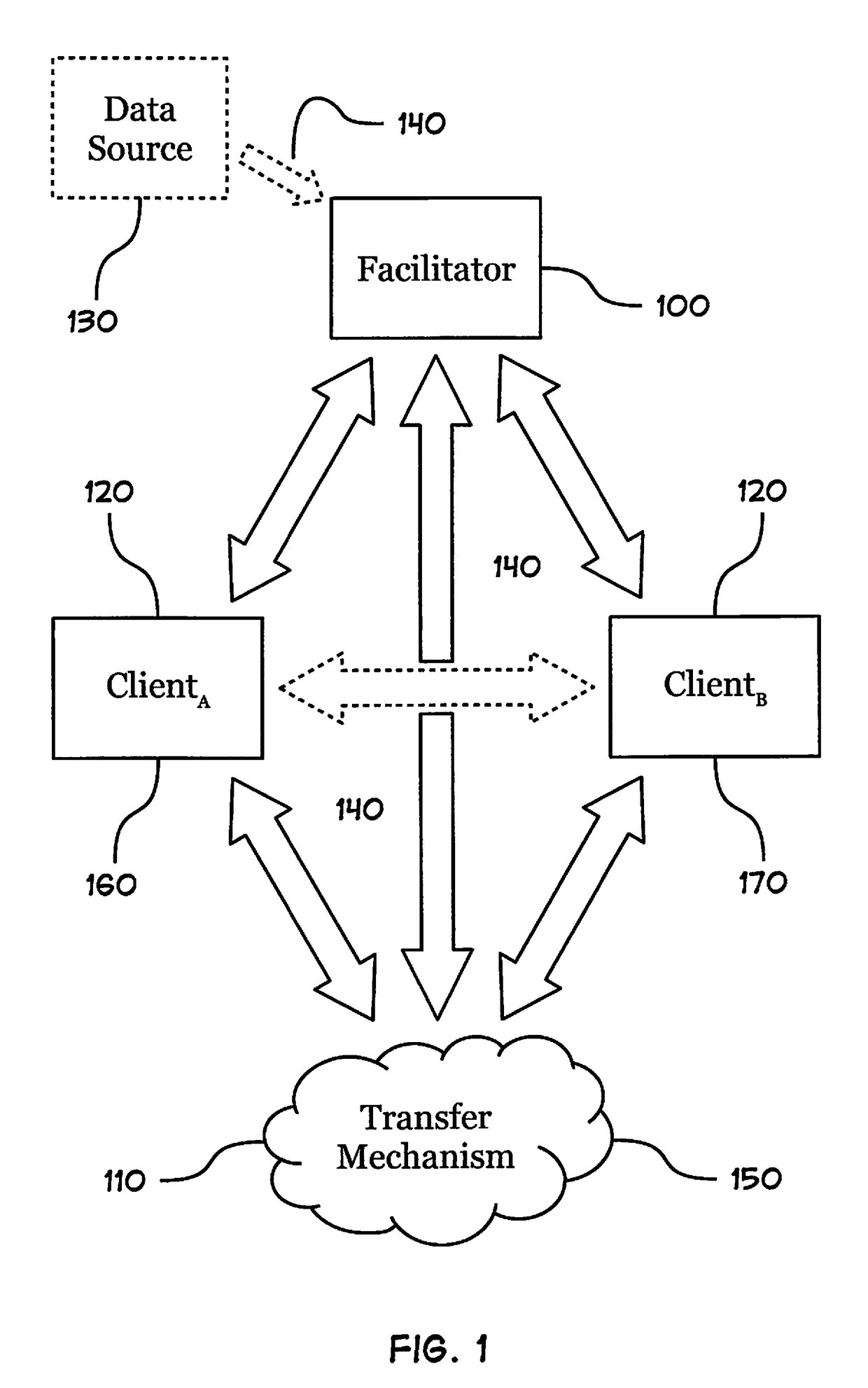

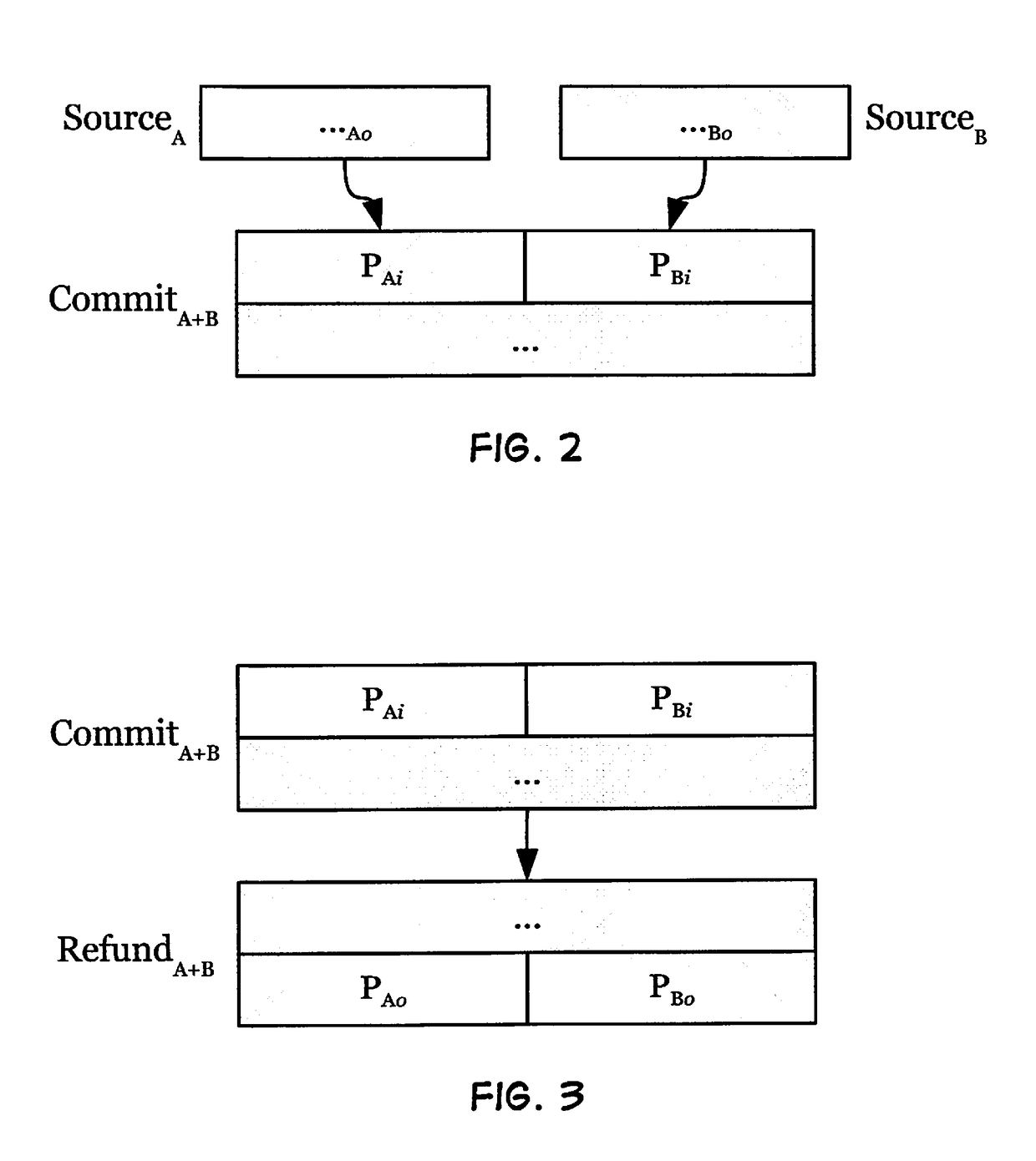

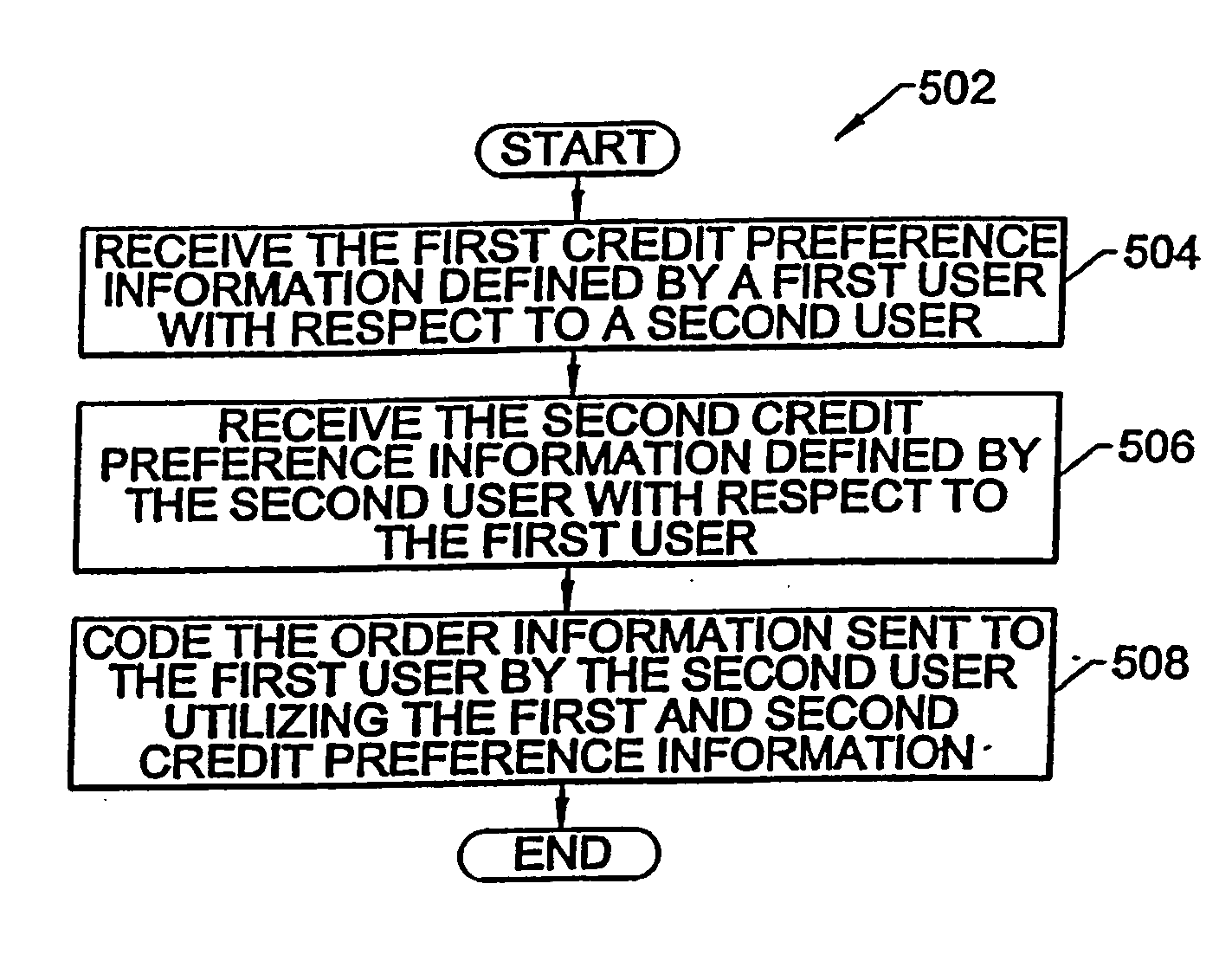

A switch engine module receive interest rate risk portfolios from a plurality of traders, and for each prospective trader, provides available switches based on positions in other counterparty portfolios that offset the viewing traders' positions. The offsetting positions are encoded with credit preference information in order to identify eligible trades based on both counterparties credit preferences. In particular, an embodiment provides for a switch auction whereby users can use an auction process to trade for forward rate agreement switches with other counterparties. In the switch auction, the price is predetermined by the system prior to the auction so that parties can opt out of the transaction if desired. The credit preferences of the participating traders are taken in consideration in making matches.

Owner:GFINET INC

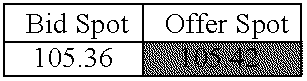

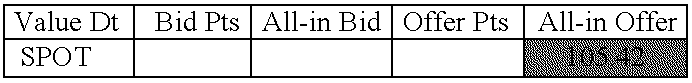

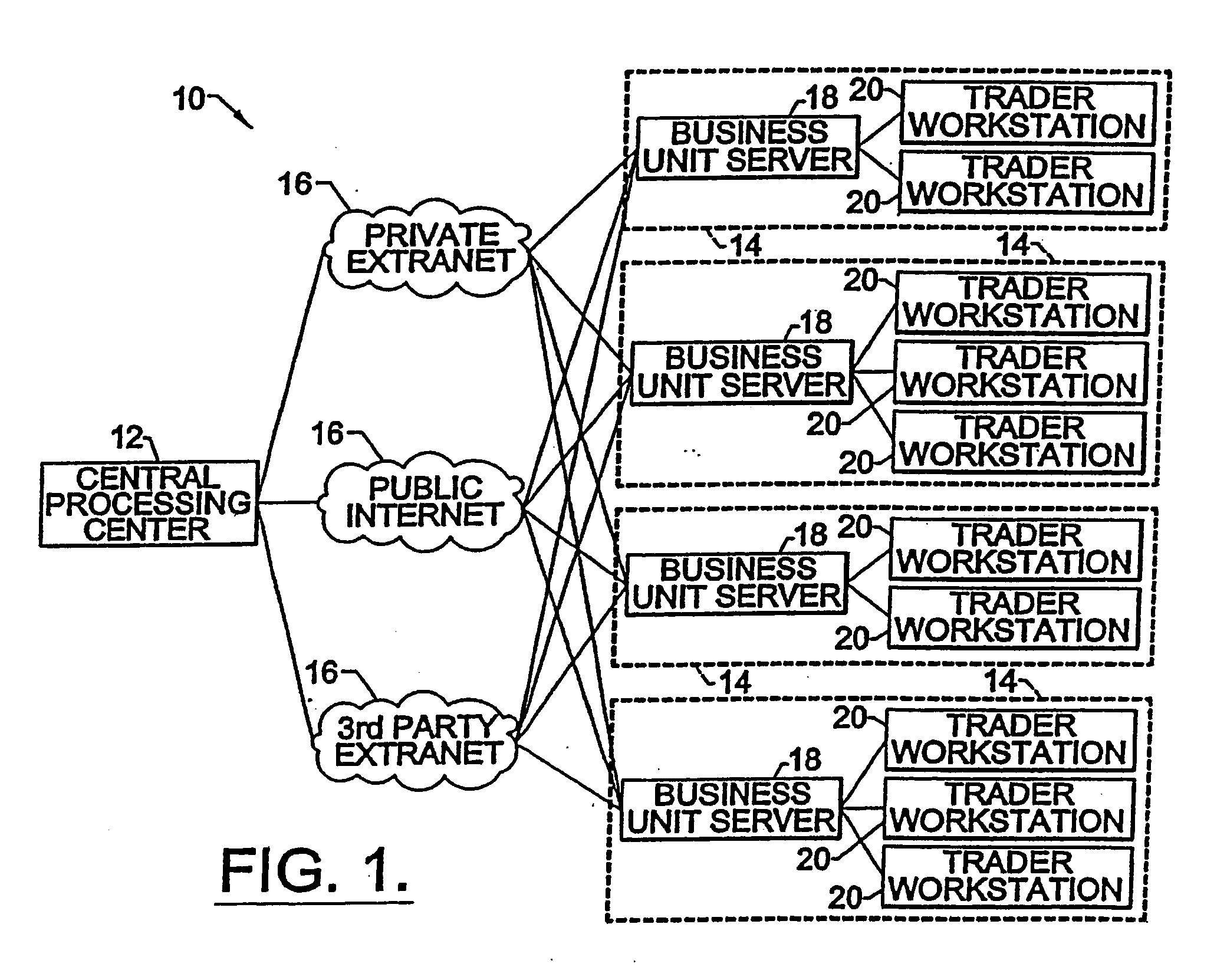

Method and apparatus for conducting financial transactions

Method and apparatus for conducting financial transactions that allows traders, market makers, dealers, and liquidity providers to negotiate with multiple customers simultaneously, and receive and respond to transaction solicitations and amendment requests in real time. The invention, which may be accessed over an interconnected data communications network, such as the Internet, using a standard Web browser, automatically provides traders with up-to-date market rates as solicitations are received, and provides a graphical user interface with sorting and filtering capabilities to organize displays to show pending and completed transactions according to user preferences. Counterparty customers engaged in transactions with the traders and dealers using the system benefit by being able to negotiate with multiple providers simultaneously, and by receiving real-time, context-sensitive transaction status messages and notifications as the negotiations take place. An optional transaction status database records transaction events in real-time and provides transaction archiving and auditing capabilities superior to conventional manual transaction systems.

Owner:FX ALLIANCE

Systems and methods for performing two-way one-to-many and many-to-many auctions for financial instruments

A switch engine module receive interest rate risk portfolios from a plurality of traders, and for each prospective trader, provides available switches based on positions in other counterparty portfolios that offset the viewing traders' positions. The offsetting positions are encoded with credit preference information in order to identify eligible trades based on both counterparties credit preferences. In particular, an embodiment provides for a switch auction whereby users can use an auction process to trade for forward rate agreement switches with other counterparties, for example, in a two-way or many-to-many auction. In the switch auction, the price is predetermined by the system prior to the auction so that parties can opt out of the transaction if desired. The credit preferences of the participating traders are taken in consideration in making matches.

Owner:GFINET INC

Credit handling in an anonymous trading system

InactiveUS20020099641A1Amount of creditReduce capacityFinancePayment architectureEngineeringCredit limit

In an anonymous trading system, credit between counterparties is effectively increased by netting buy and sell trades to reflect the true risk to which each party is exposed. Credit limits are adjusted by calculating the exposure in each currency at the relevant time and then converted into the credit limit currency equivalent. The credit limits are adjusted accordingly. The resulting credit limits may be different for bids and offers by or from a given counterparty.

Owner:NEX SERVICES NORTH AMERICA +2

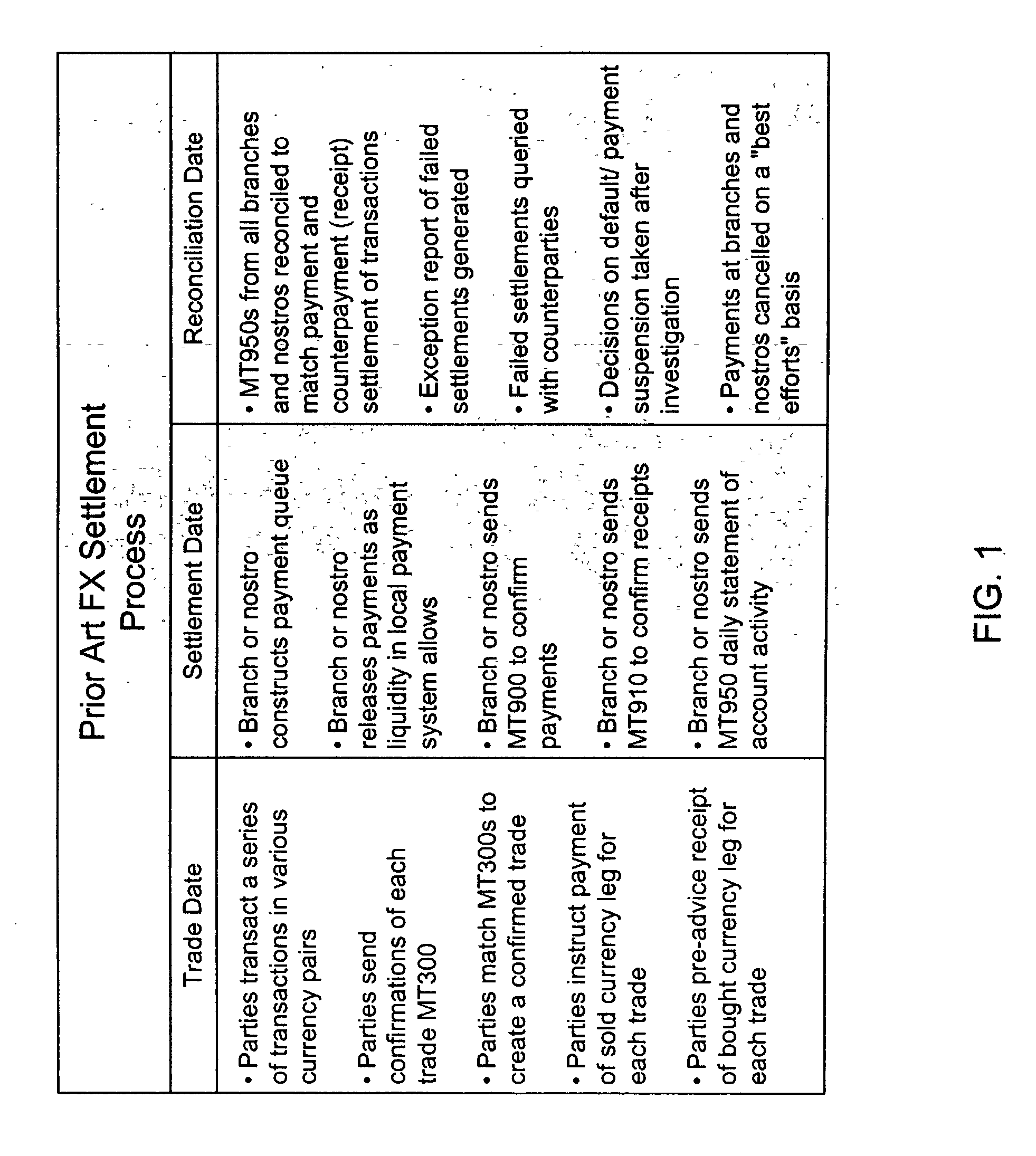

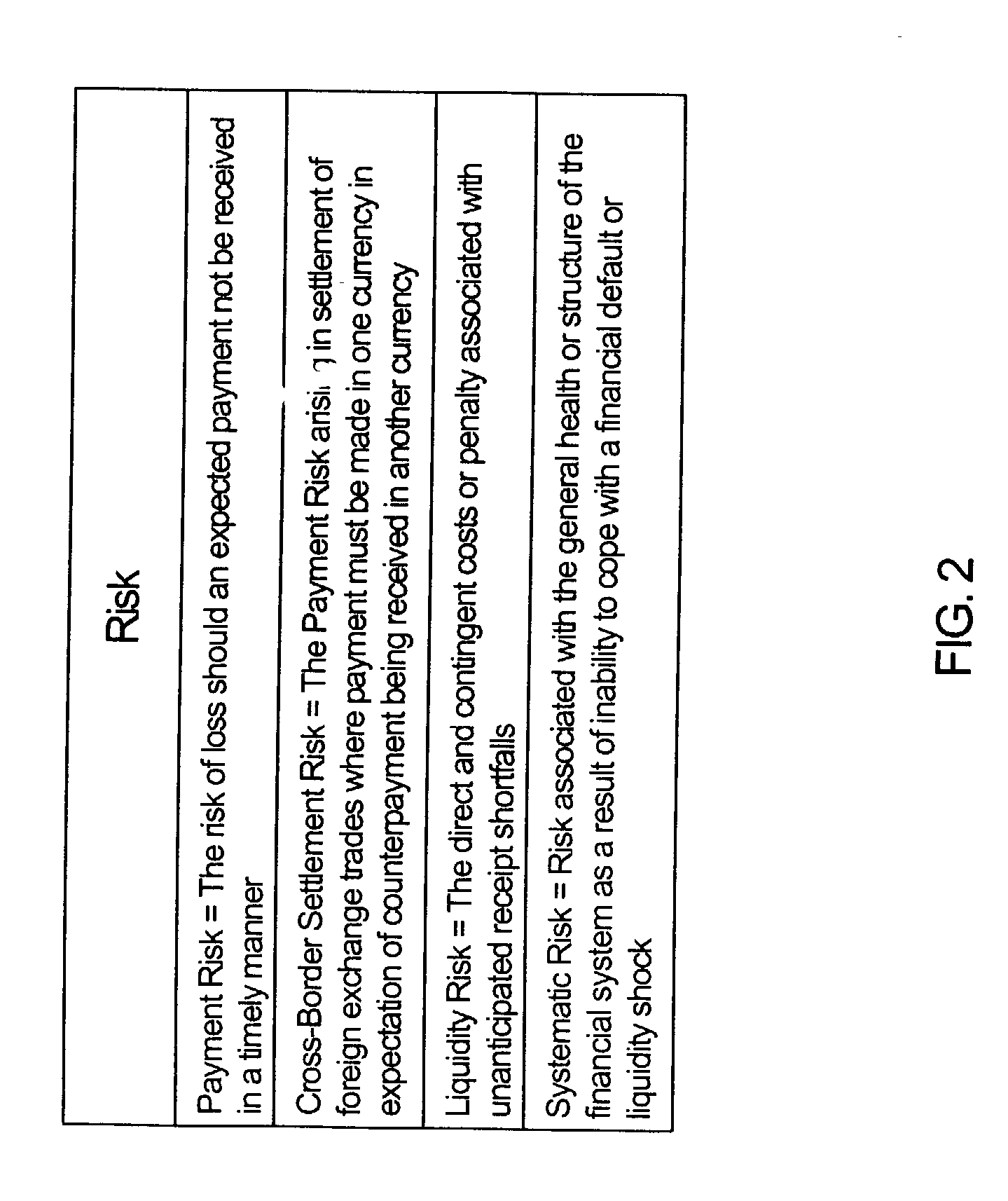

Method of and system for mitigating risk associated with settling of foreign exchange and other payments-based transactions

InactiveUS20020152156A1Improve liquidityFacilitates broad range of communicationFinanceBilling/invoicingPrivate communicationThird party

A real-time, global system and method for controlling payments risk, liquidity risk and systemic risk arising between financial counterparties active in payments-based transactions. The system comprises: a plurality of User Host Applications for use by plurality of Users; a plurality of Third Party Host Applications for use by plurality of Third Parties; and a plurality of Payment Bank Host Applications for use by a plurality of Payment Banks operating a plurality of domestic payment systems. All host applications communicate via cryptographically secure sessions via private communications networks and / or the Internet global computer network. User and Payment Bank access is secured by digital certification. Each Payment Bank Host Application has a mechanism for processing payment messages, including payments instructions to be carried out in its domestic payments system on behalf of a plurality of account holders (including bank correspondents). In addition, each Payment Bank Host Application includes a filter process module for processing payments instructions, prior to being carried out by the domestic payment system. In the event of a counterparty payment failure or insolvency, the Filter Process Module enables instantaneous, automated suspension of all further payments to the counterparty in a multiplicity of chosen currencies on instruction from a Third Party, User or Payment Bank. The filter process module can also be instructed to override risk control parameters to enable payments to proceed regardless for identified transactions, counterparties or intermediaries. All applications improve the availability and timeliness of payments information. The reduction in payments risk and liquidity risk to predetermined tolerances reduces the likelihood of contingent defaults in the event of payment failure due to bank insolvency or other unforeseen event, and thereby reduces systemic risk to the global financial system.

Owner:MIND FUSION LLC

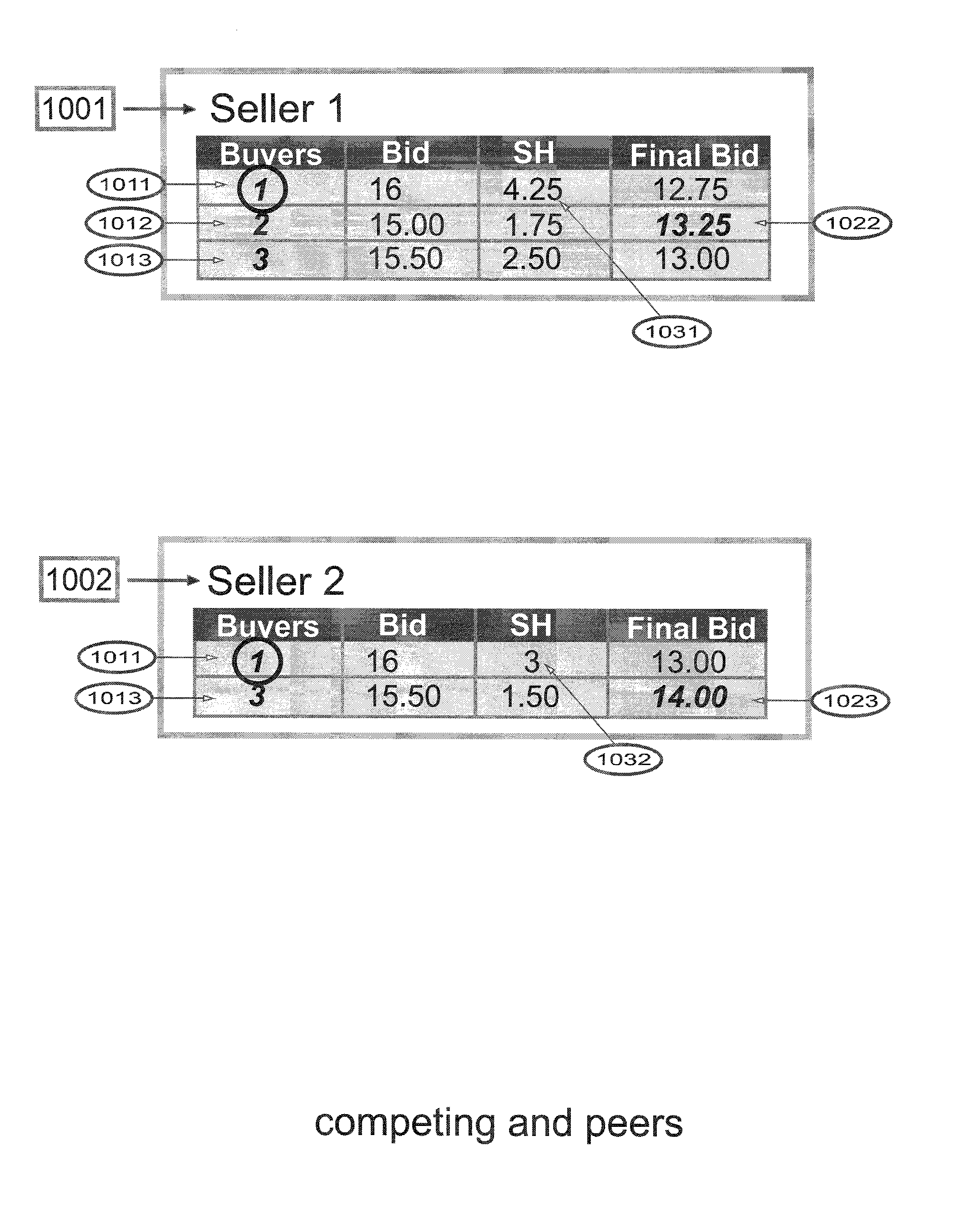

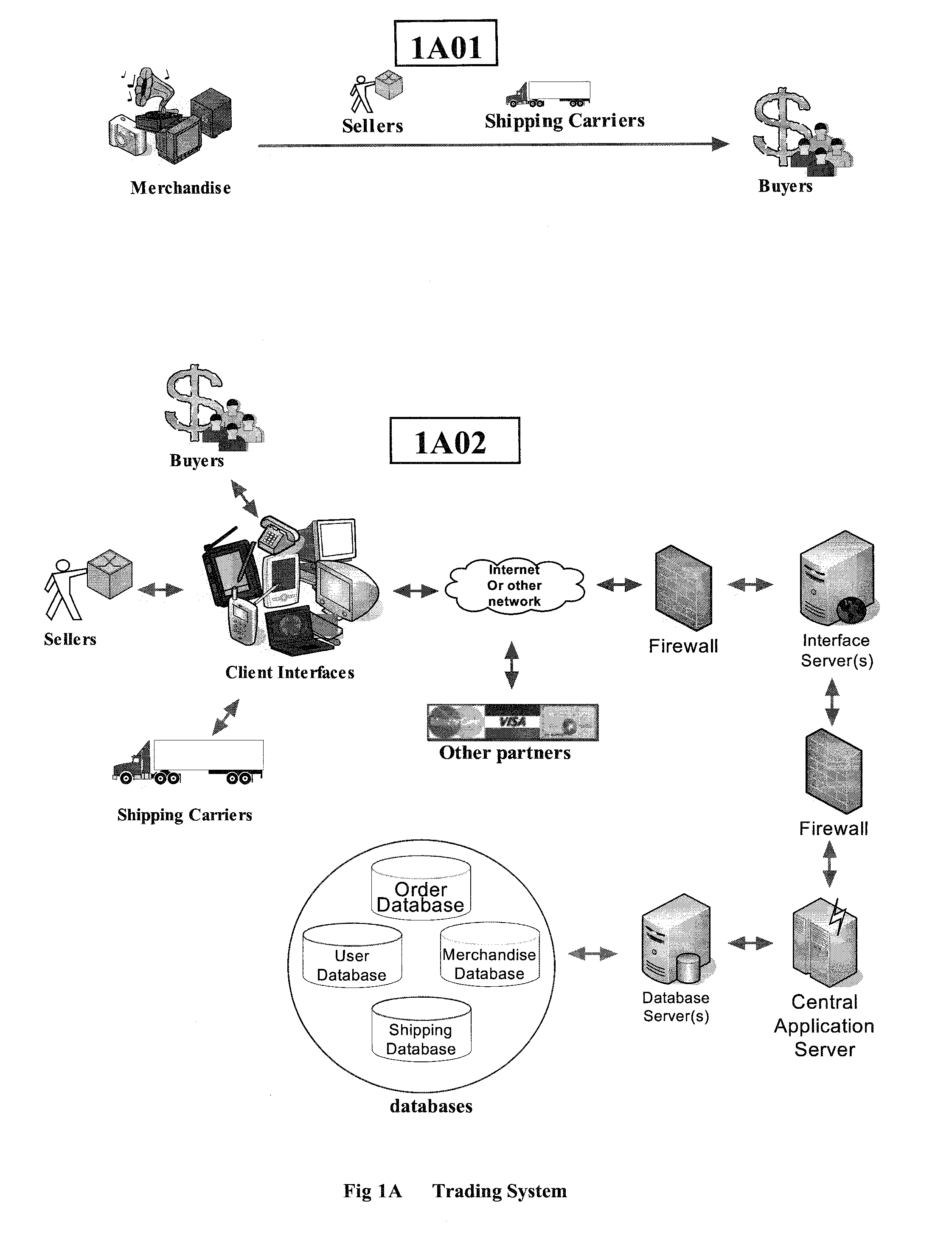

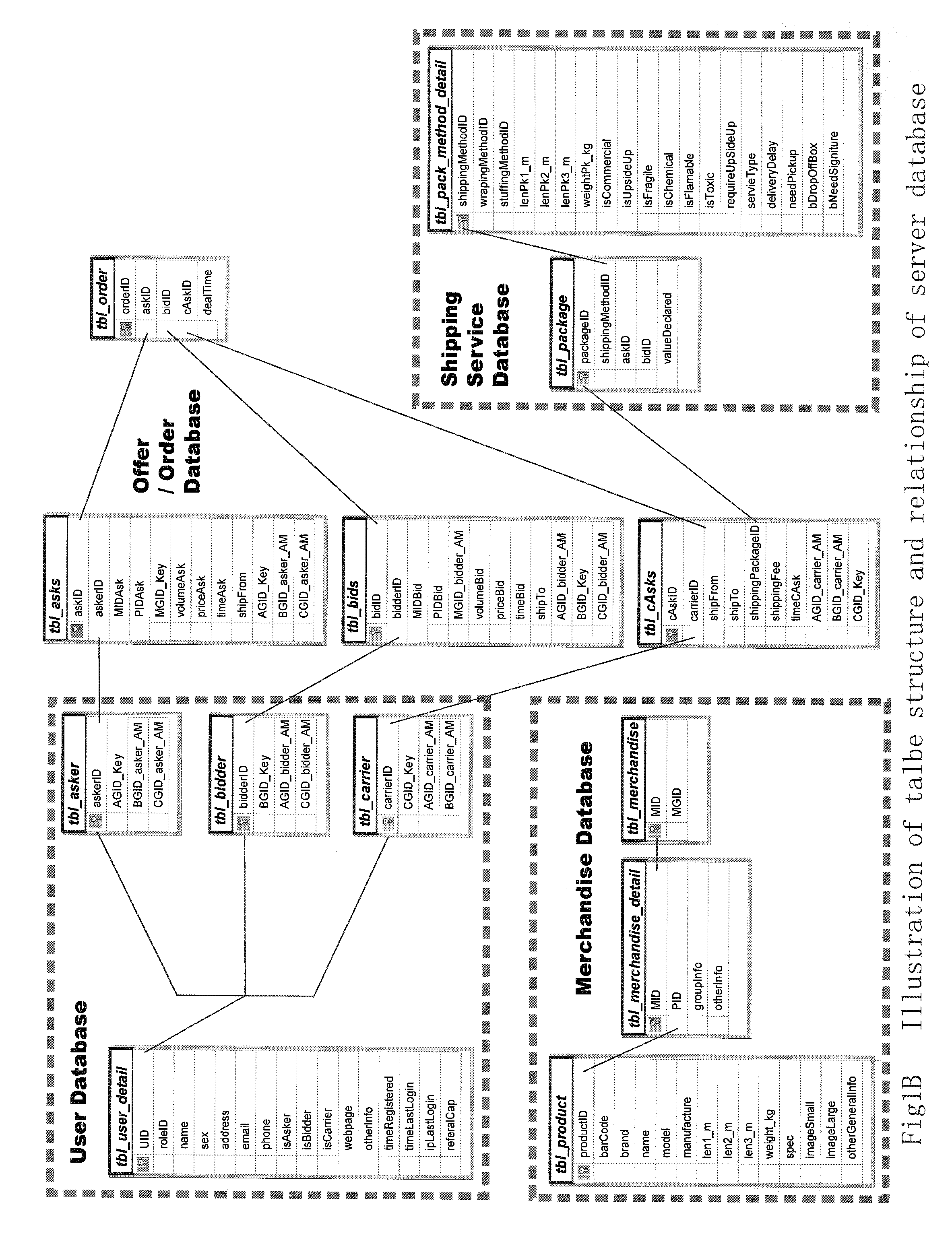

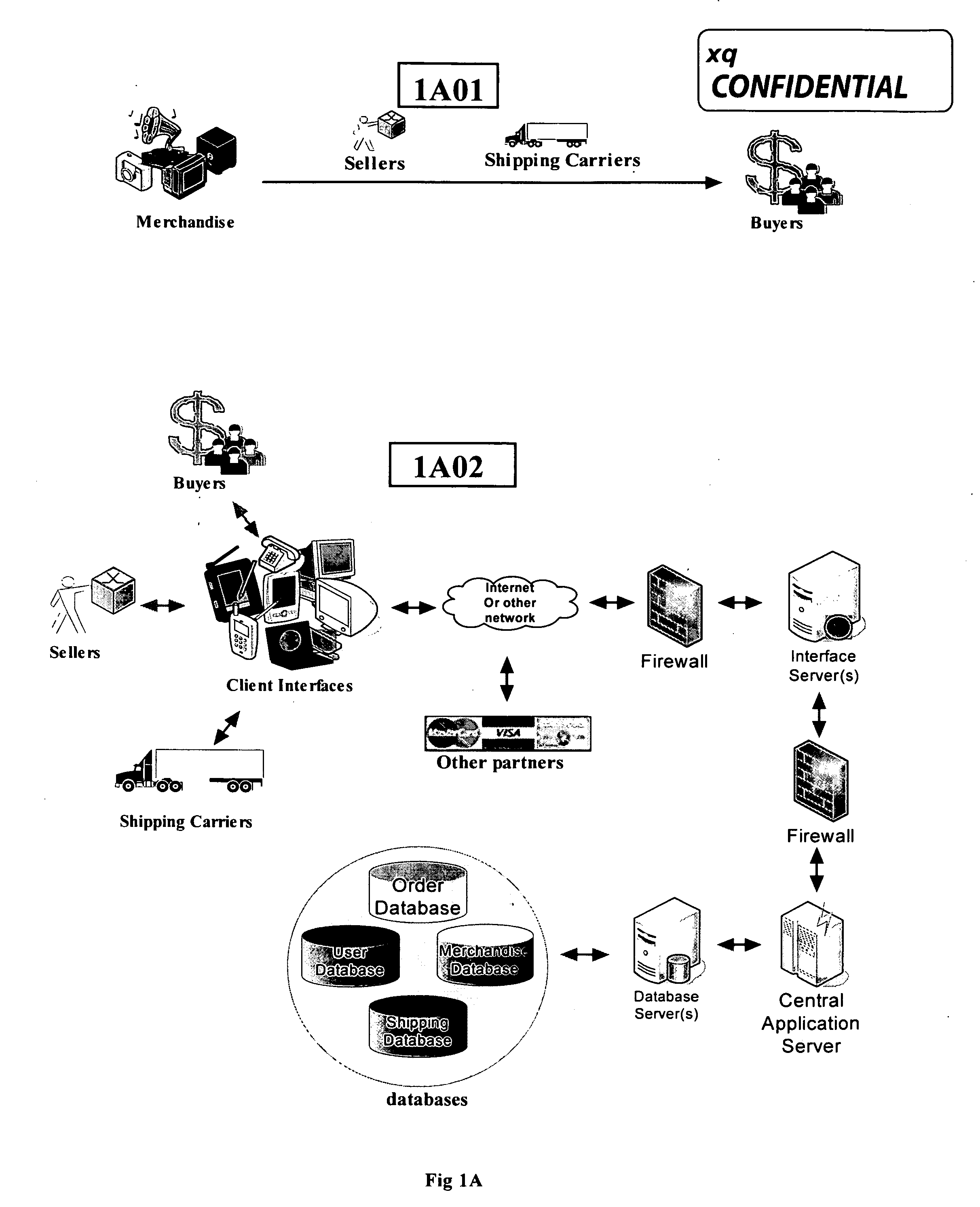

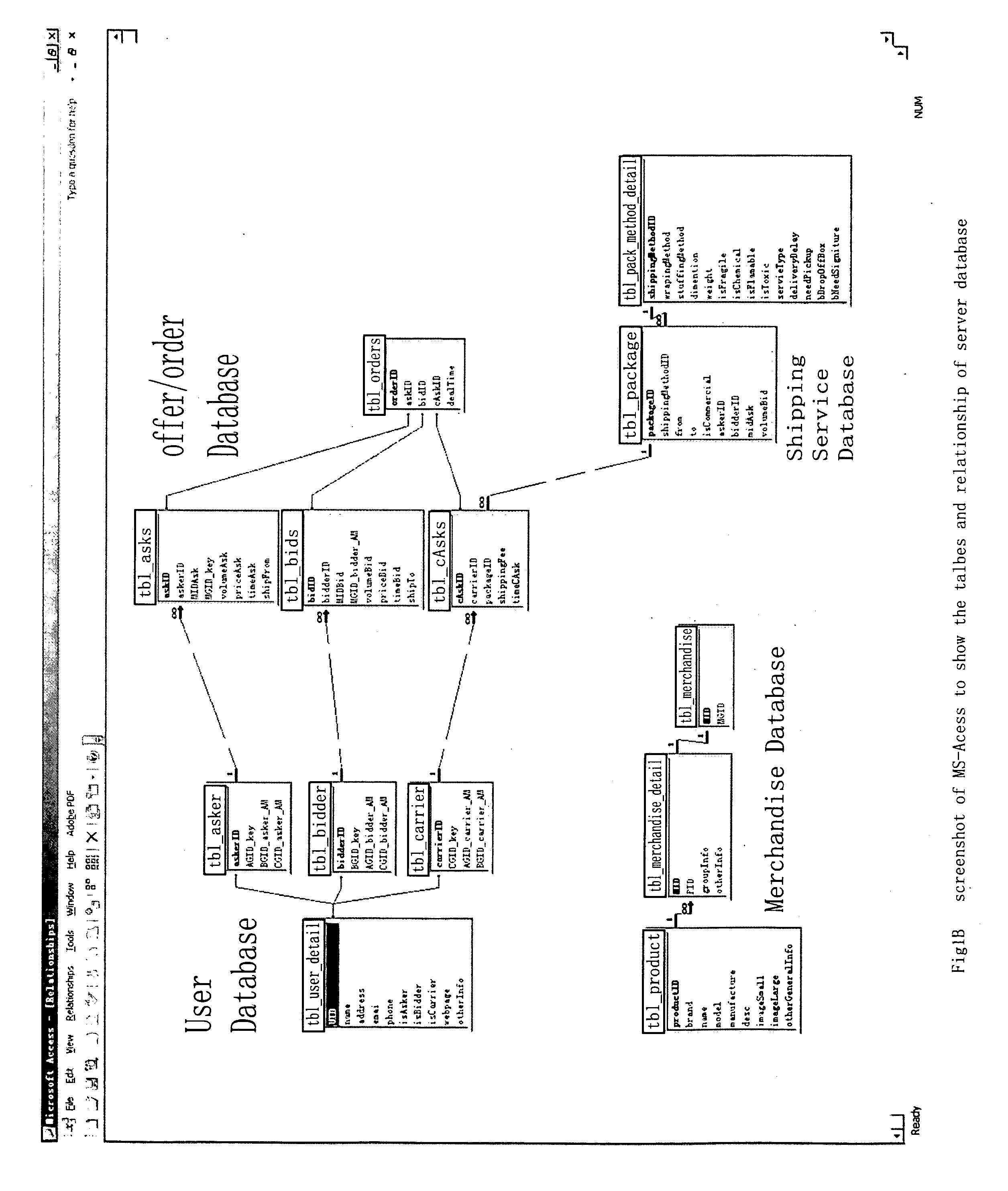

Method and system for grouping merchandise, services and users and for trading merchandise and services

This method groups multiple merchandises (products / services) and multiple traders (buyer / sellers / carriers) that share similar properties with a Merchandise Group ID (MGID) and a User Group ID (UGID), respectively. Each MGID and UGID represents one Merchandise Group and Trader Group, respectively. Different MGIDs and UGIDs represent different merchandise and trader groups. The method also utilize a multi-party matching mechanism to trade Merchandise Groups among Trader Groups by having grouped buyers / sellers / carriers place bid / ask / cAsk offers on both the merchandise and any shipping services required to fulfill the transaction. Based on offers received, the system calculates Gap Values in real-time to determine if deals can be closed. Like stock tickers, MGID enables grouped merchandise to be traded like stocks. UGID enables grouped traders to trade desired merchandise with acceptable counterparties through matching both MGIDs and UGIDs. Based on the grouping, matching and gap value calculating mechanism, this method changes “Instance Trading” into “Group Trading”.

Owner:XIAO QUAN +1

Method and system for grouping merchandise, services and users and for trading merchandise and services

The apparatus and method disclosed herein is a new e-commerce business model and its possible embodiments. By grouping merchandise and users, the invention provides new interfaces between multiple merchandises / service, multiple askers and multiple bidders. Certain merchandises / services will be identified and grouped with a Merchandise Group ID (MGID). Each MGID represents a group of merchandise / service with some common properties. MGID works like the stock tickers, which represents all products from the same category. It then enables users (bidders / askers / shipping carriers), who are also grouped by their User Group ID (UGID), to put bid / ask / cAsk offers on the above said merchandise or the shipping services. With MGIDs, the merchandise and service would then be identified and traded like stocks. With UGID that categorize users into user groups and then matching UGID, one group of users can find the counterparty user group they would like to deal with much easier. It reshapes the business operation chain of current e-commerce. It combines all elements (merchandise / services / users) of the chain with same / similar / equivalent properties into corresponding groups and assigns these groups with identifier—the groupID. Grouped users are identified by User Group ID (UGID). They can select their desired counterparties through the counterparties' UGID. Matched parties (buyer / sellers / carriers) can then trade grouped merchandise / services by using the merchandise / service's Group ID (MGID) like trading stock tickers. This invention changes the current “Instance Trading”, which only deals with each single pieces of merchandise instance, into “Group Trading”, which is based on categorized merchandise groups and categorized user groups. It provides communication and interaction between these user groups and merchandise groups. MGID, BGID, AGID and CGID work together to divide all bid / ask / cAsk offers into subgroups. It then peer matches the offers within each subgroup of records to find out the final matched orders for that subgroup. This new business model will also provide a much broader stage for shipping service carriers and manufactures. Every component of the business chain has been offered an adequate position and weight to make the market operate more efficient, transparent and fair. The new trading platform will also help to enhance payment performances and security by reducing payment fraud.

Owner:XIAO QUAN +1

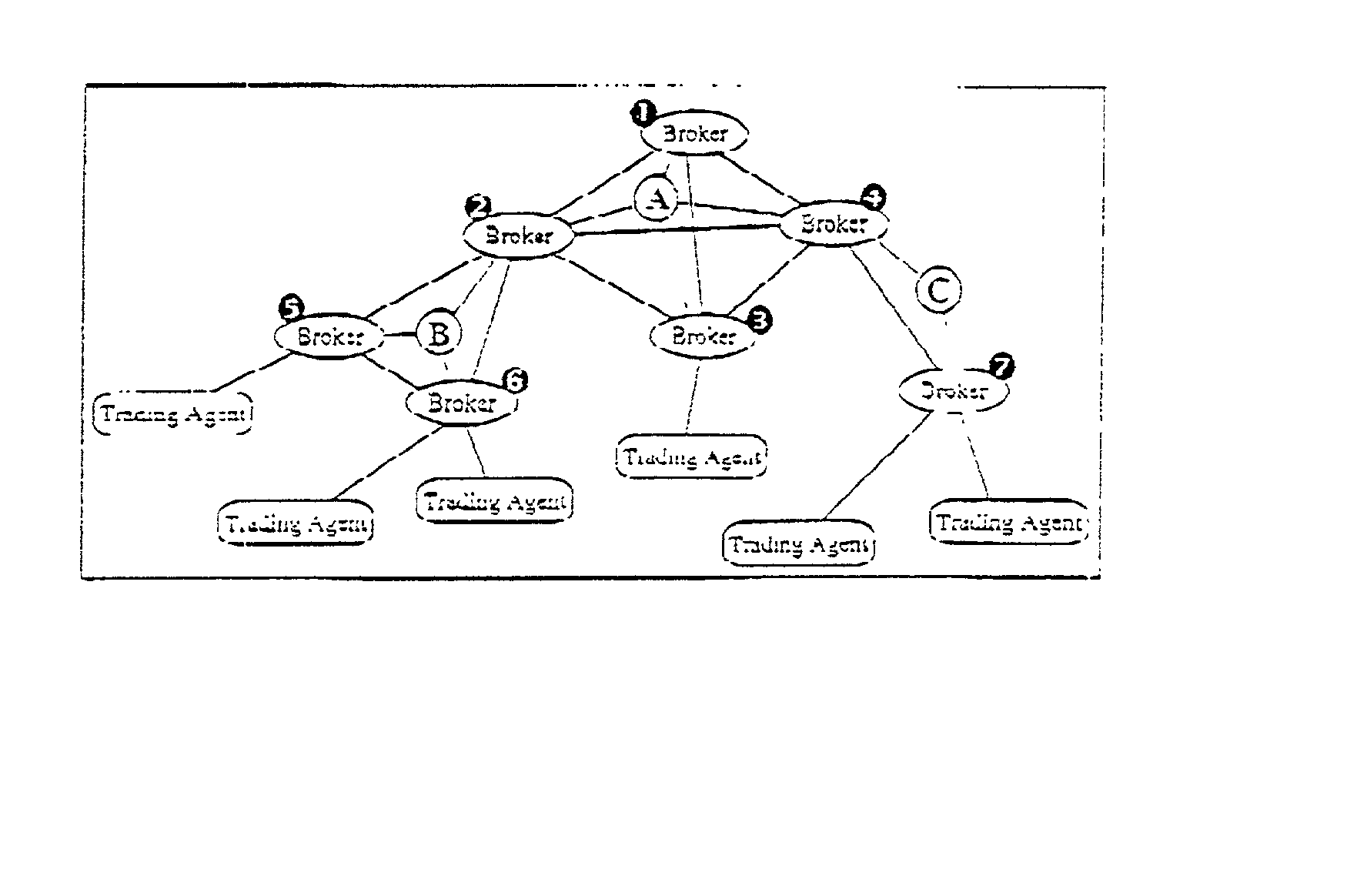

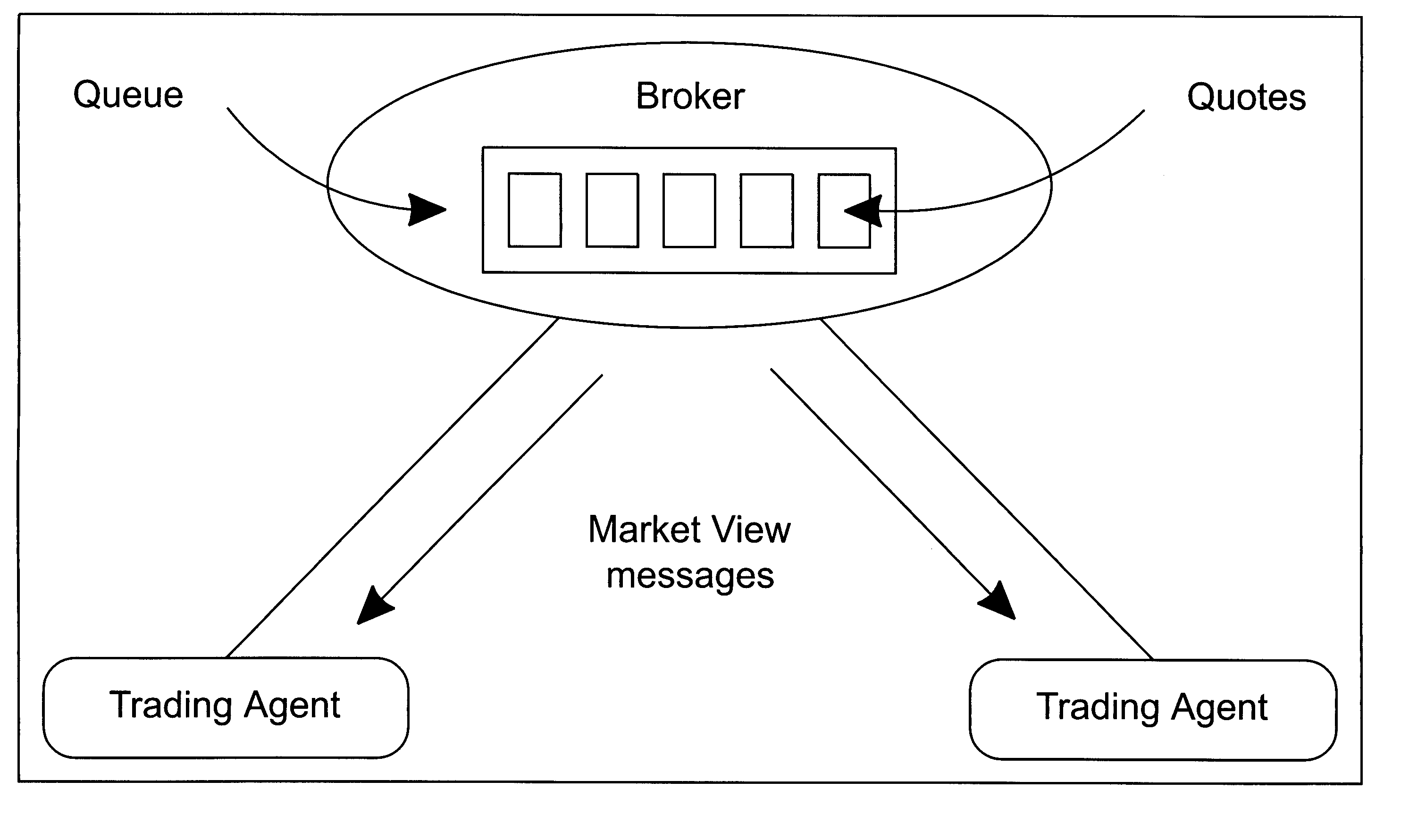

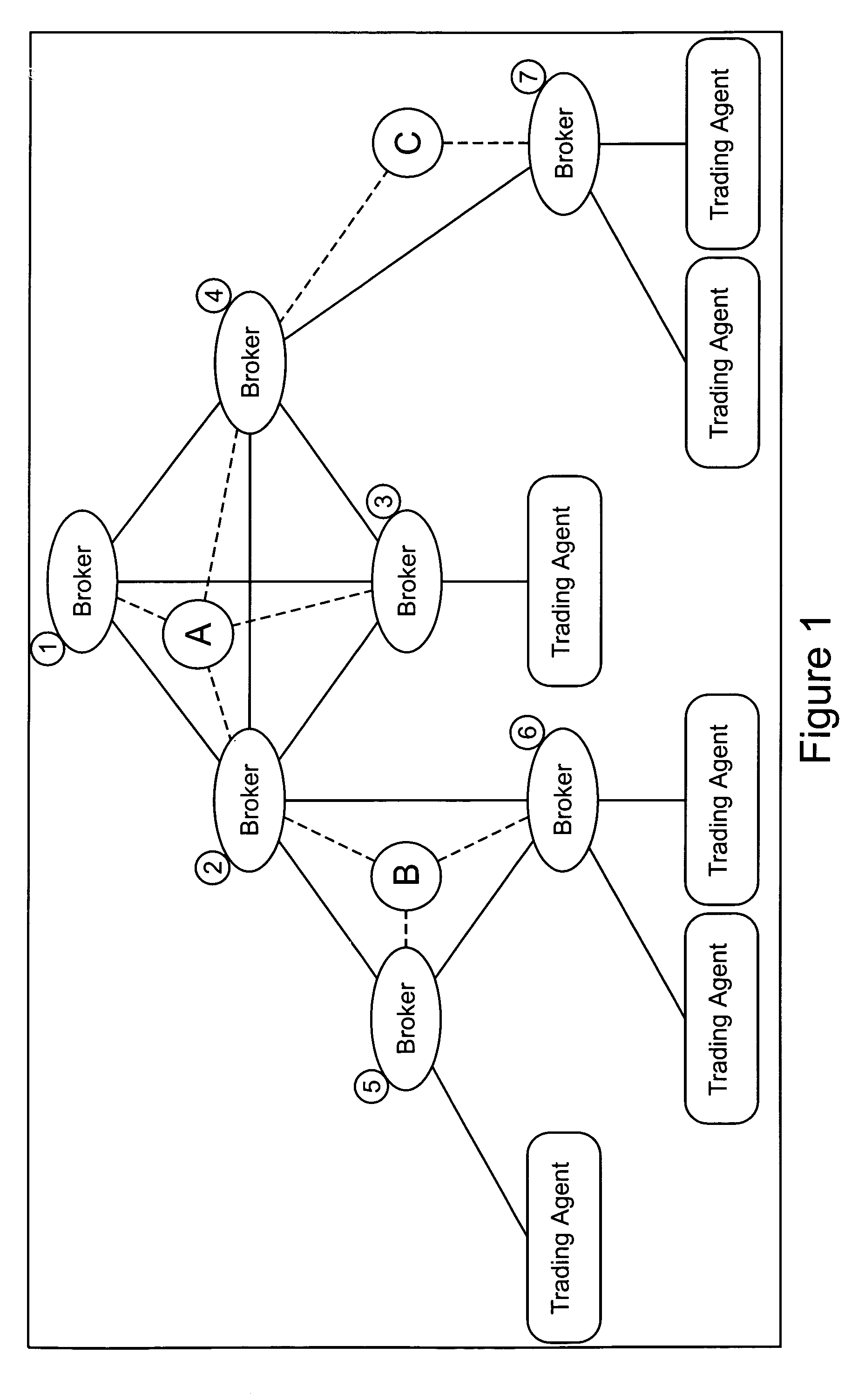

Credit management for electronic brokerage system

InactiveUS6985883B1Maintaining anonymitySpecial service provision for substationFinanceConfidentialityData mining

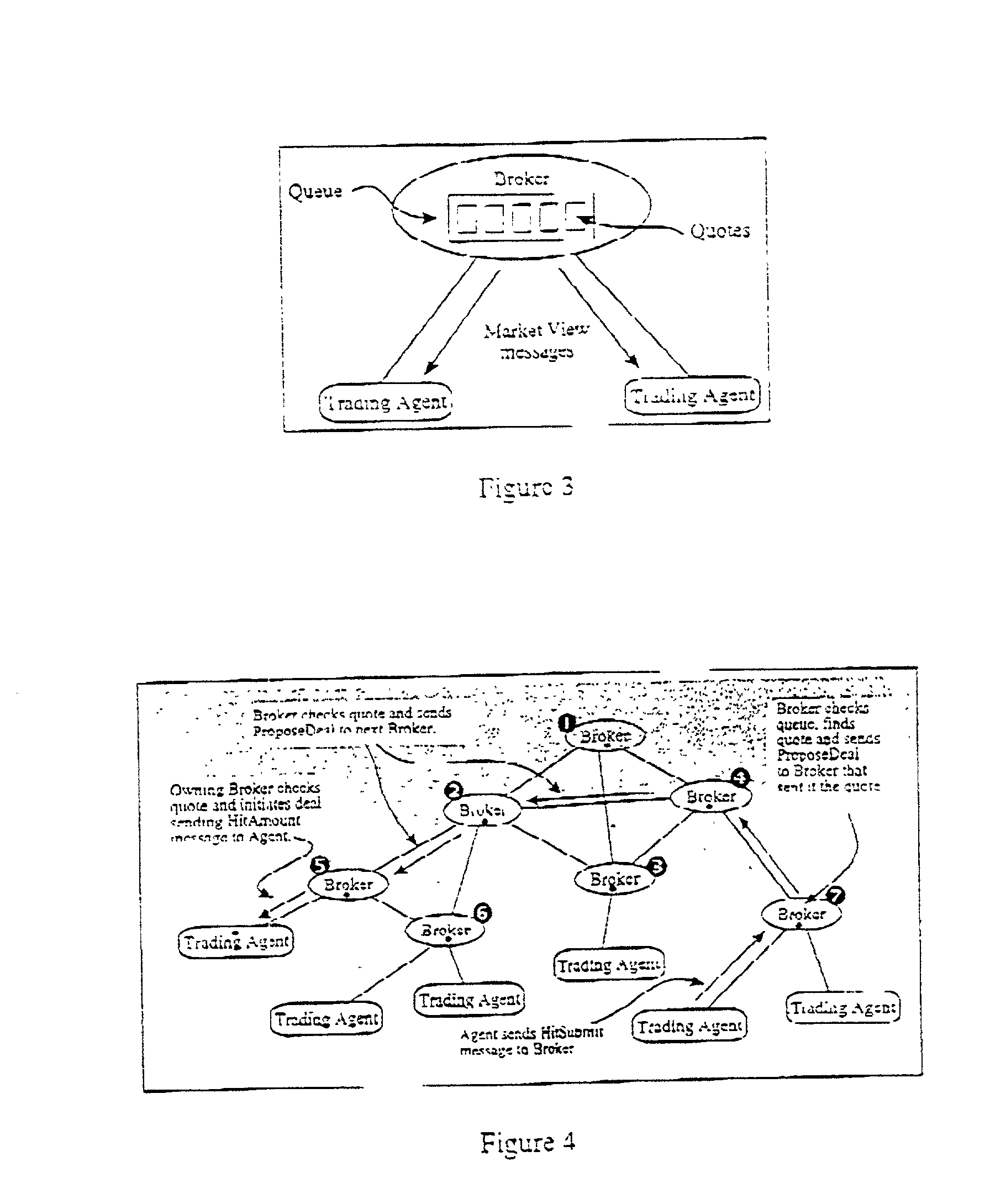

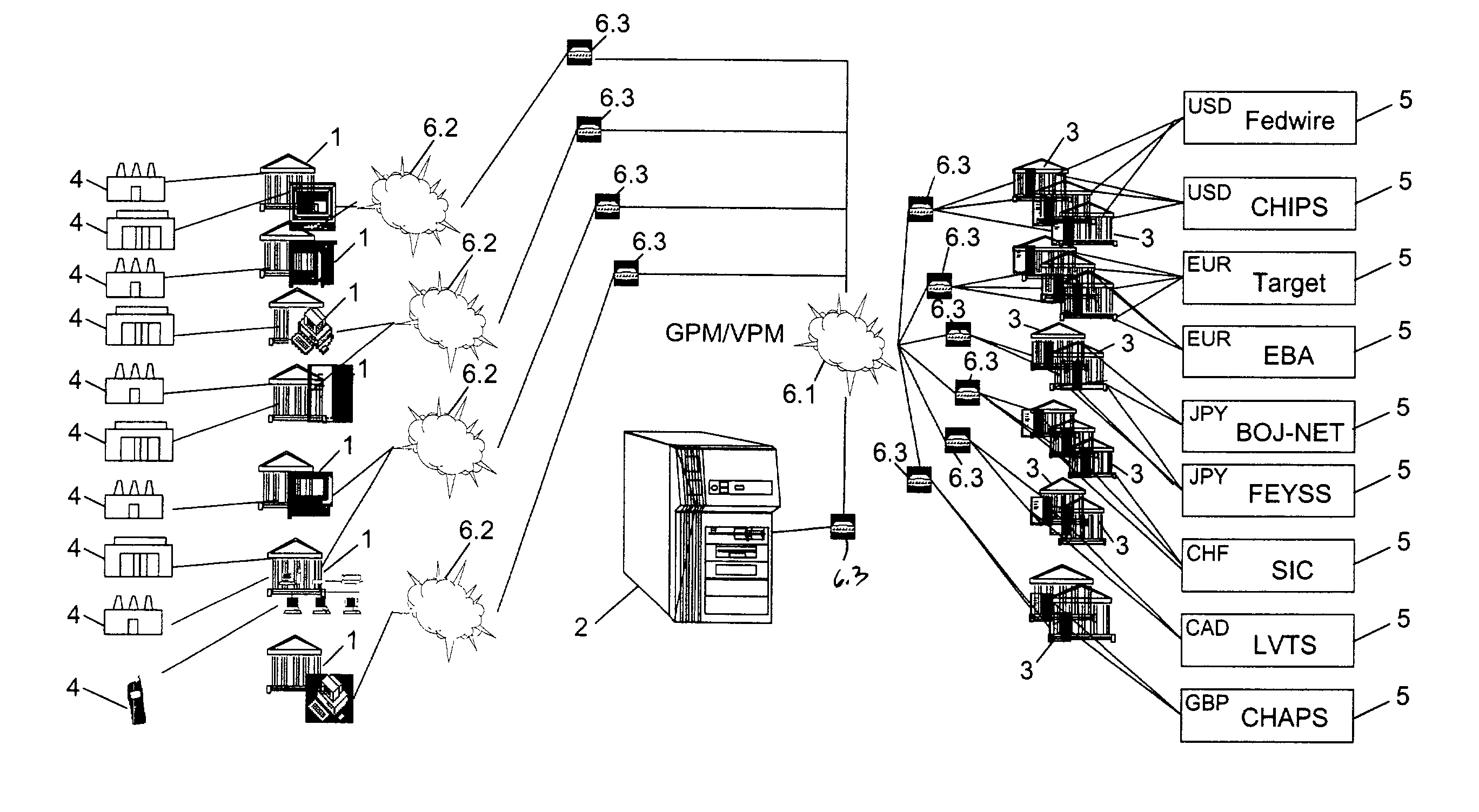

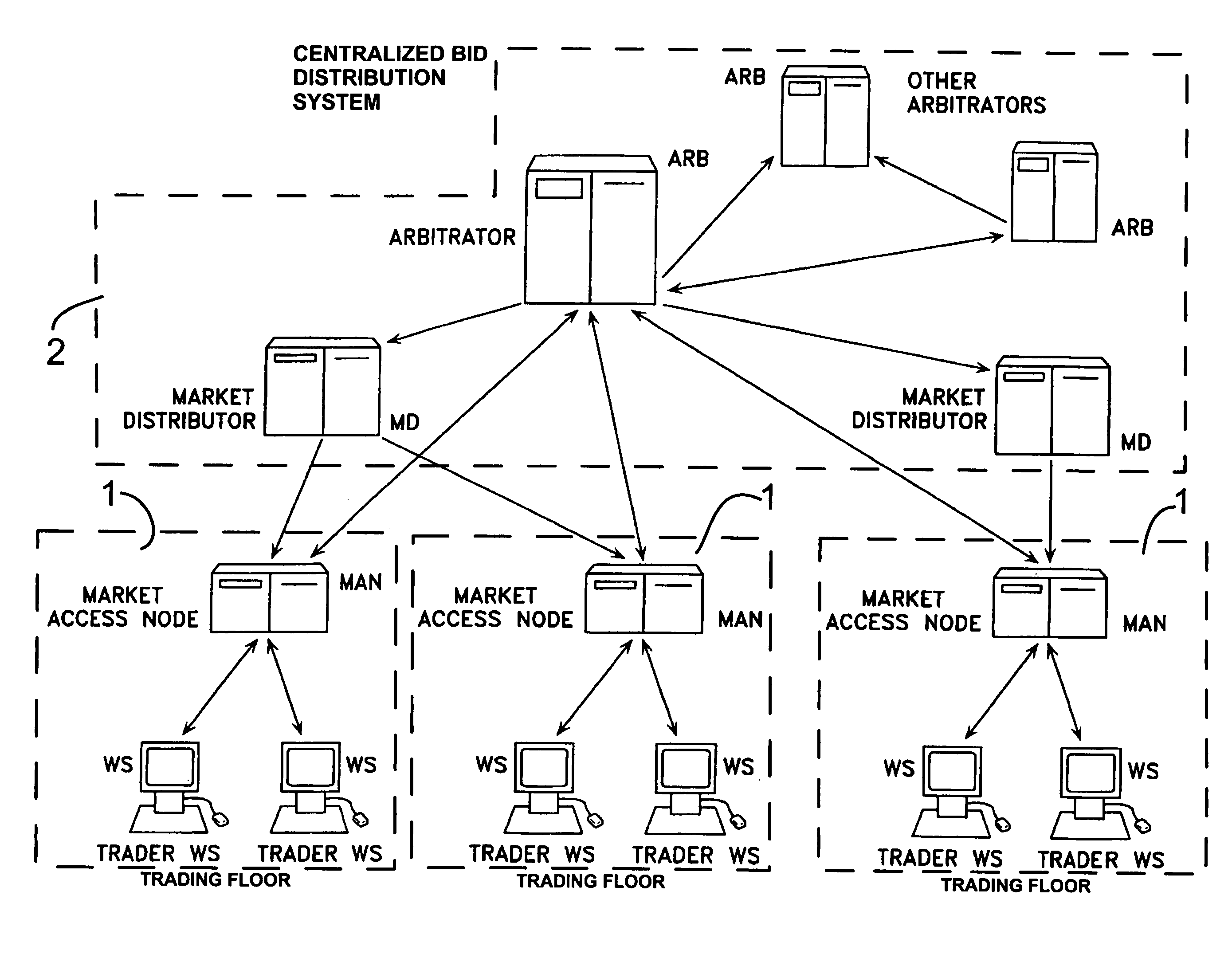

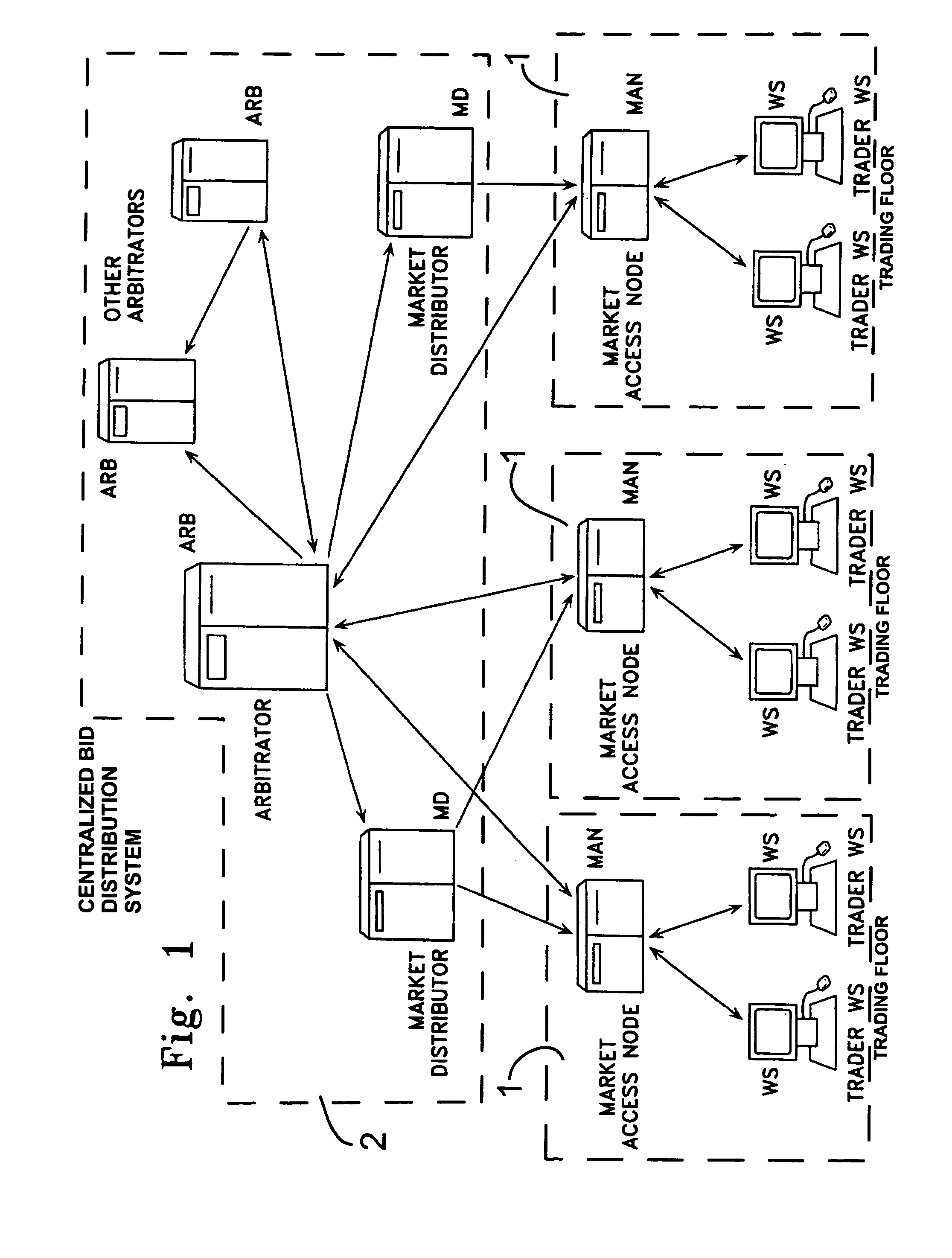

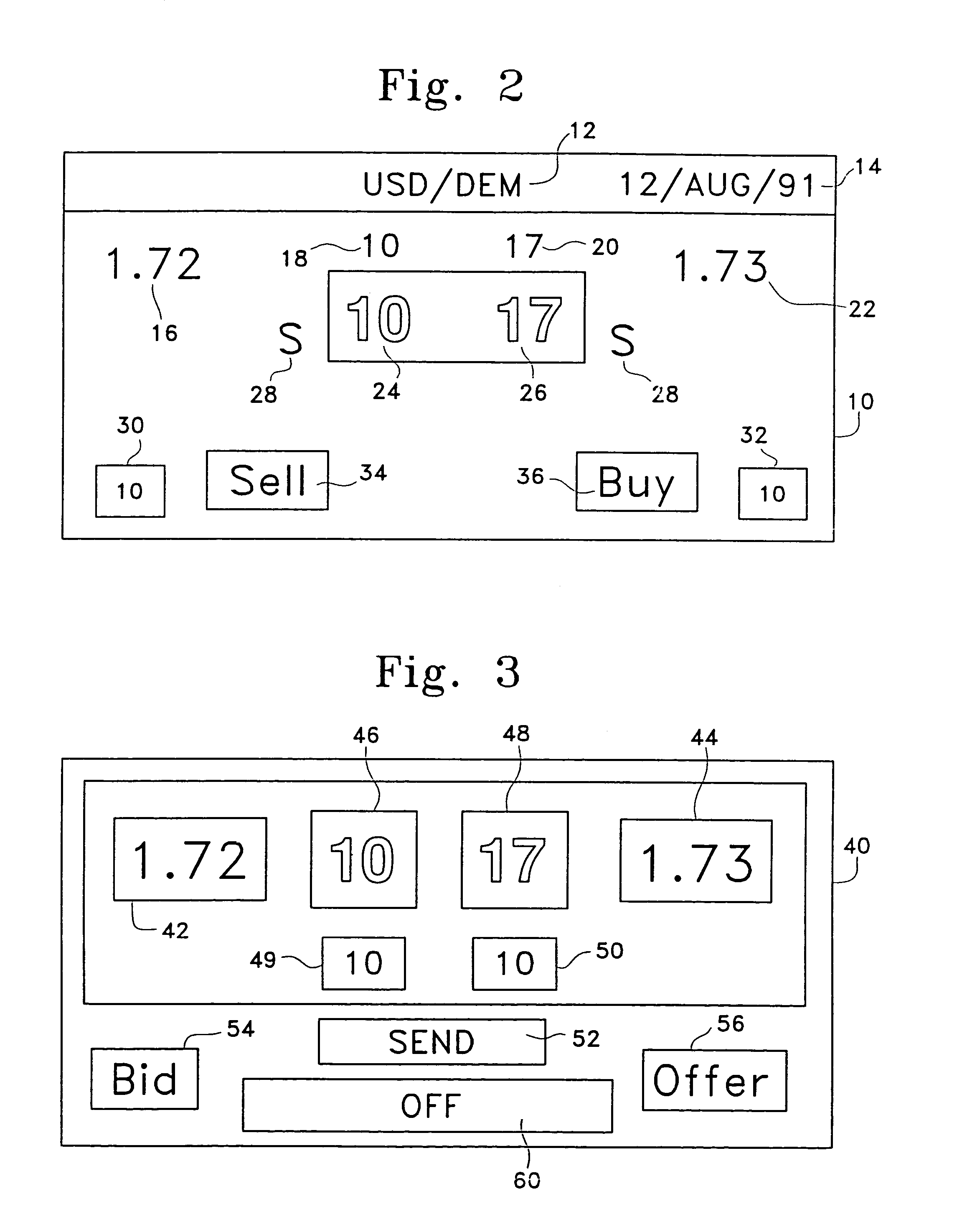

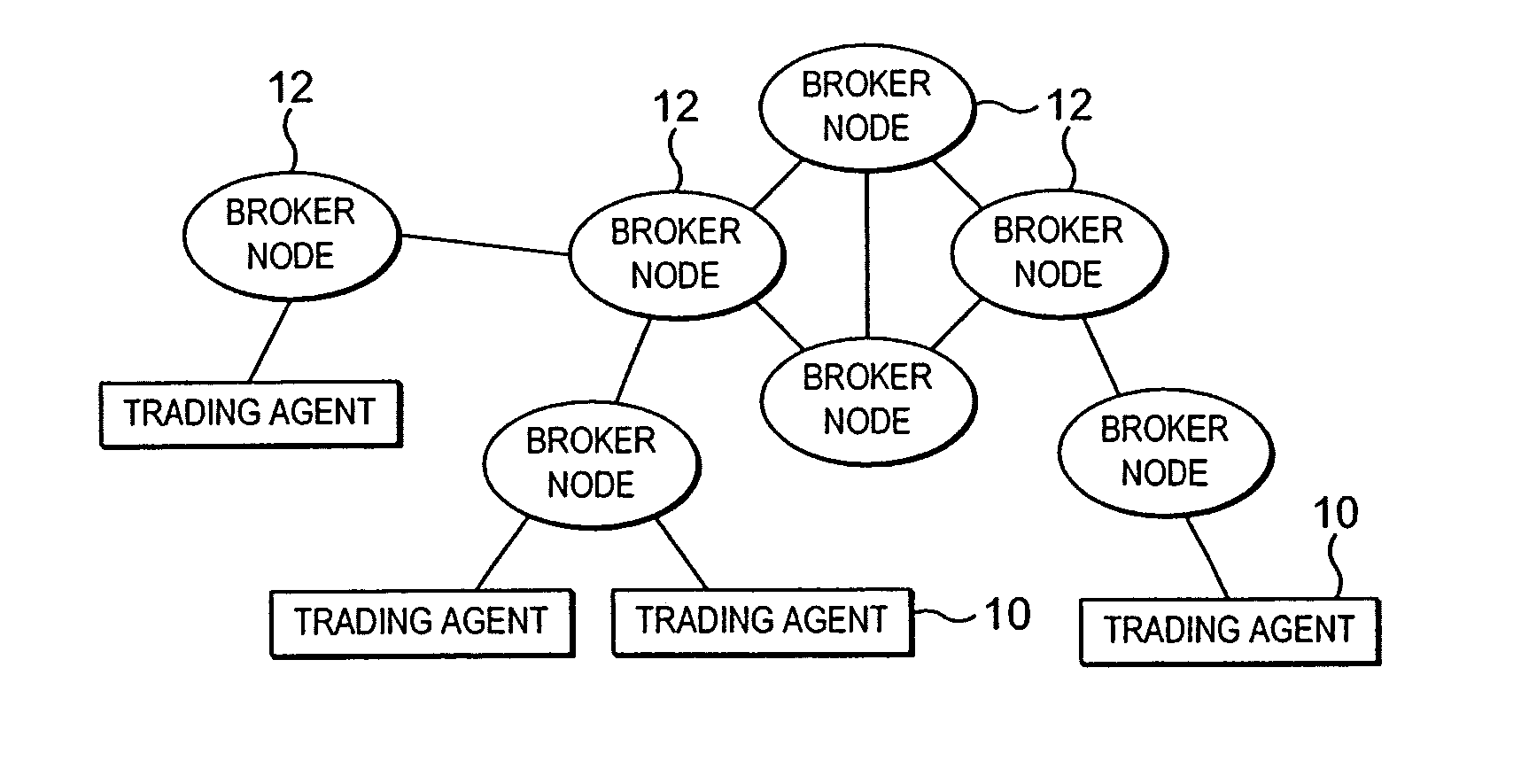

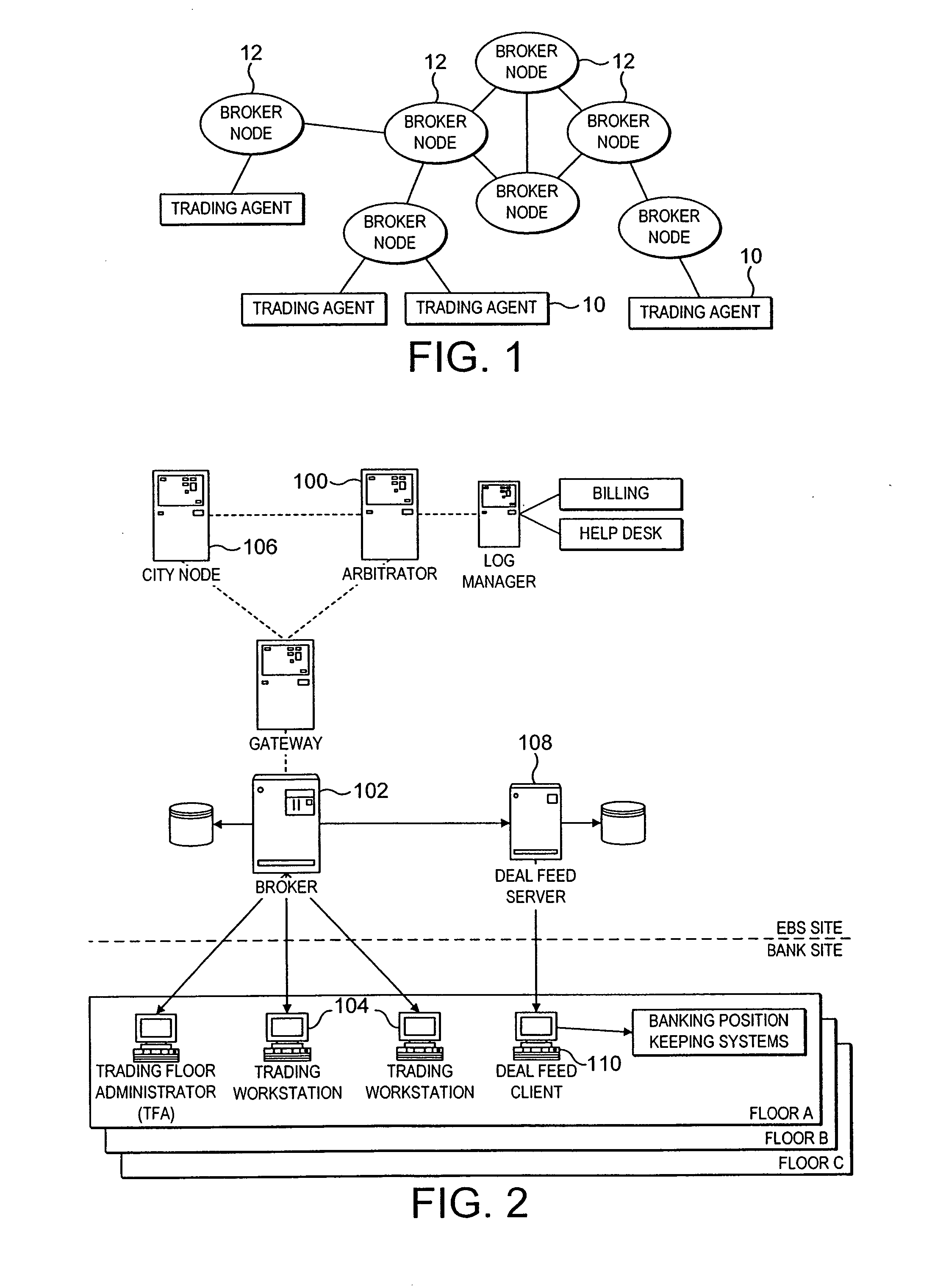

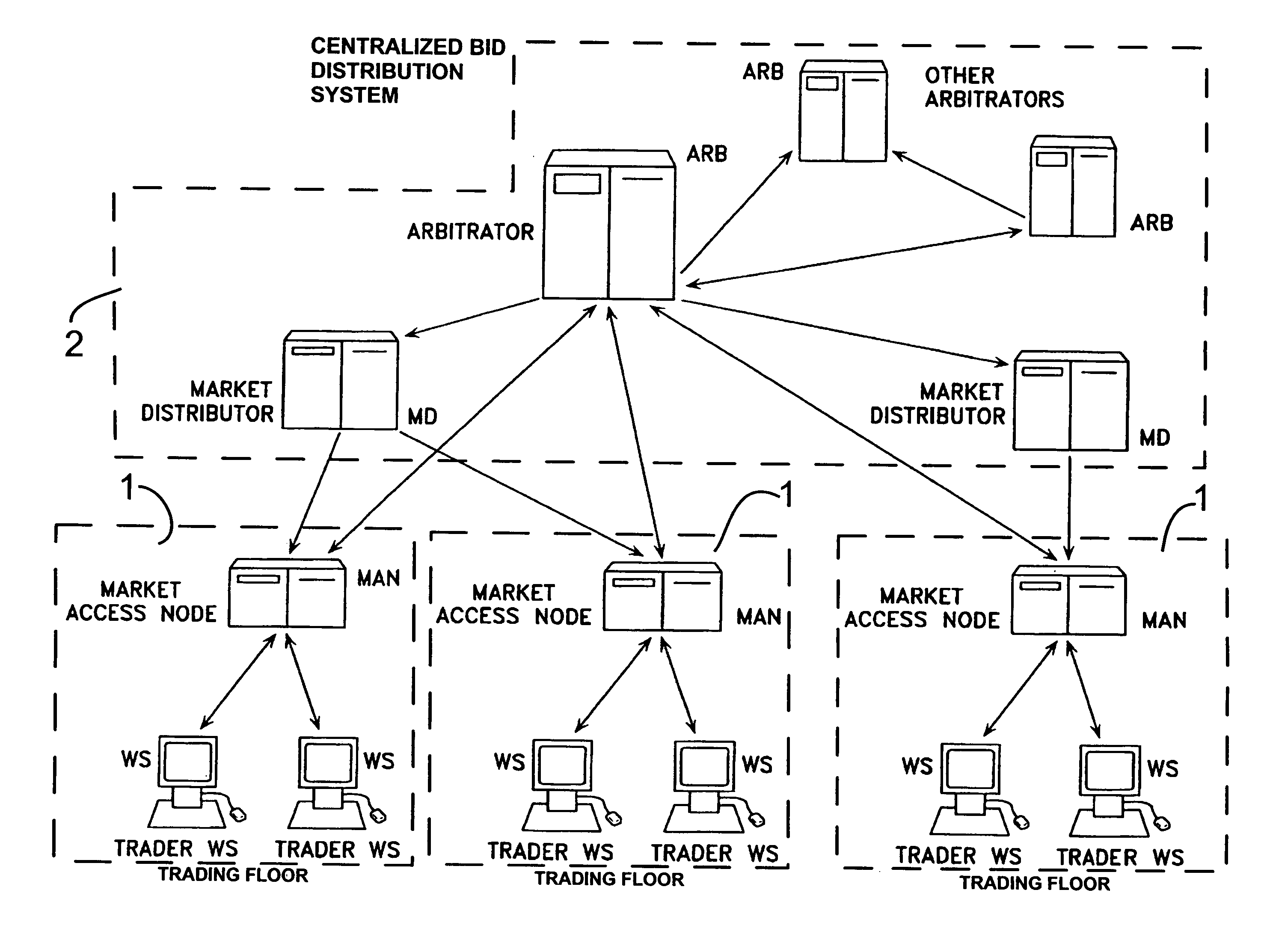

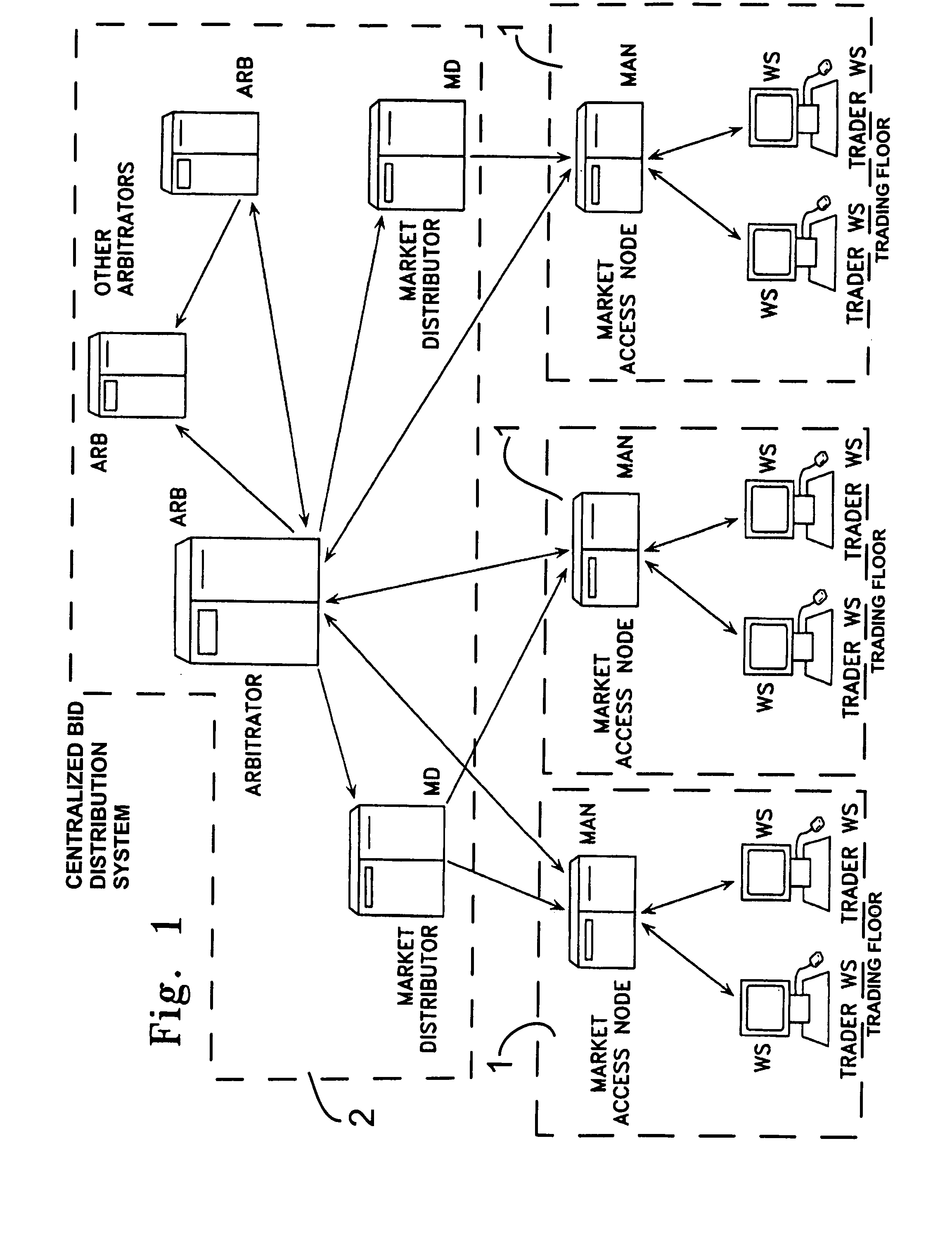

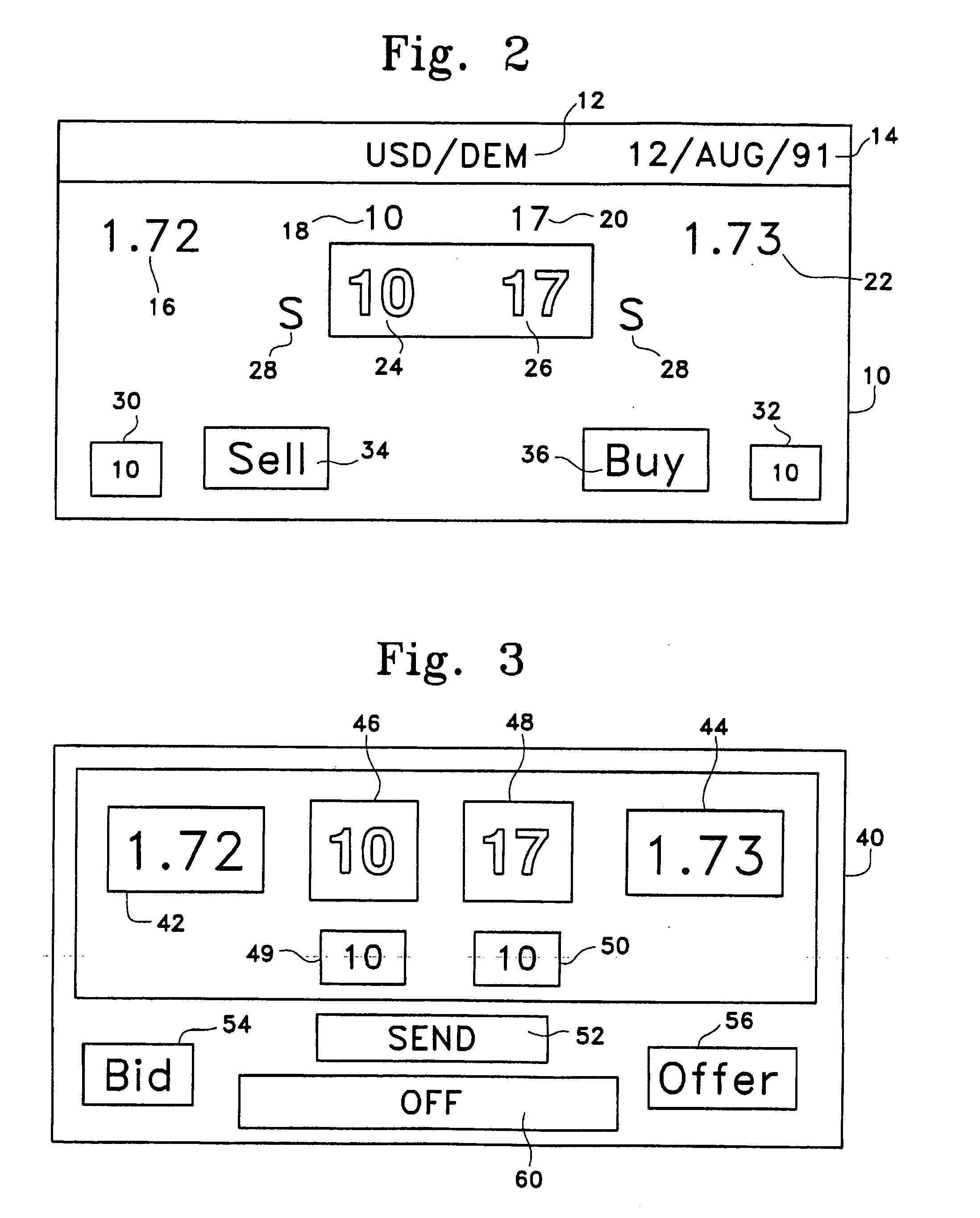

An anonymous trading system (FIG. 1) identifies the best bids and offers (QuoteSubmit, FIG. 3) from those counterparties (WS A1a1) with which each party (WS A1fb1, WS A1b2, ... WS A2a2) is currently eligible to deal, while maintaining the anonymity of the potential counterparty and the confidentiality of any specific credit limitations imposed by the anonymous potential counterparty. To that end, each bid or offer (QuoteSubmit, FIG. 3) for a particular type of financial instrument is prescreened by the system for compatibility with limited credit information (for example, a one bit flag indicating whether a predetermined limit has already been exceeded) and an anonymous “Dealable” price (24,26) is calculated for each of the traders (WS A1b, . . . WS A2a) dealing with that particular financial instrument.

Owner:EBS DEALING RESOURCES

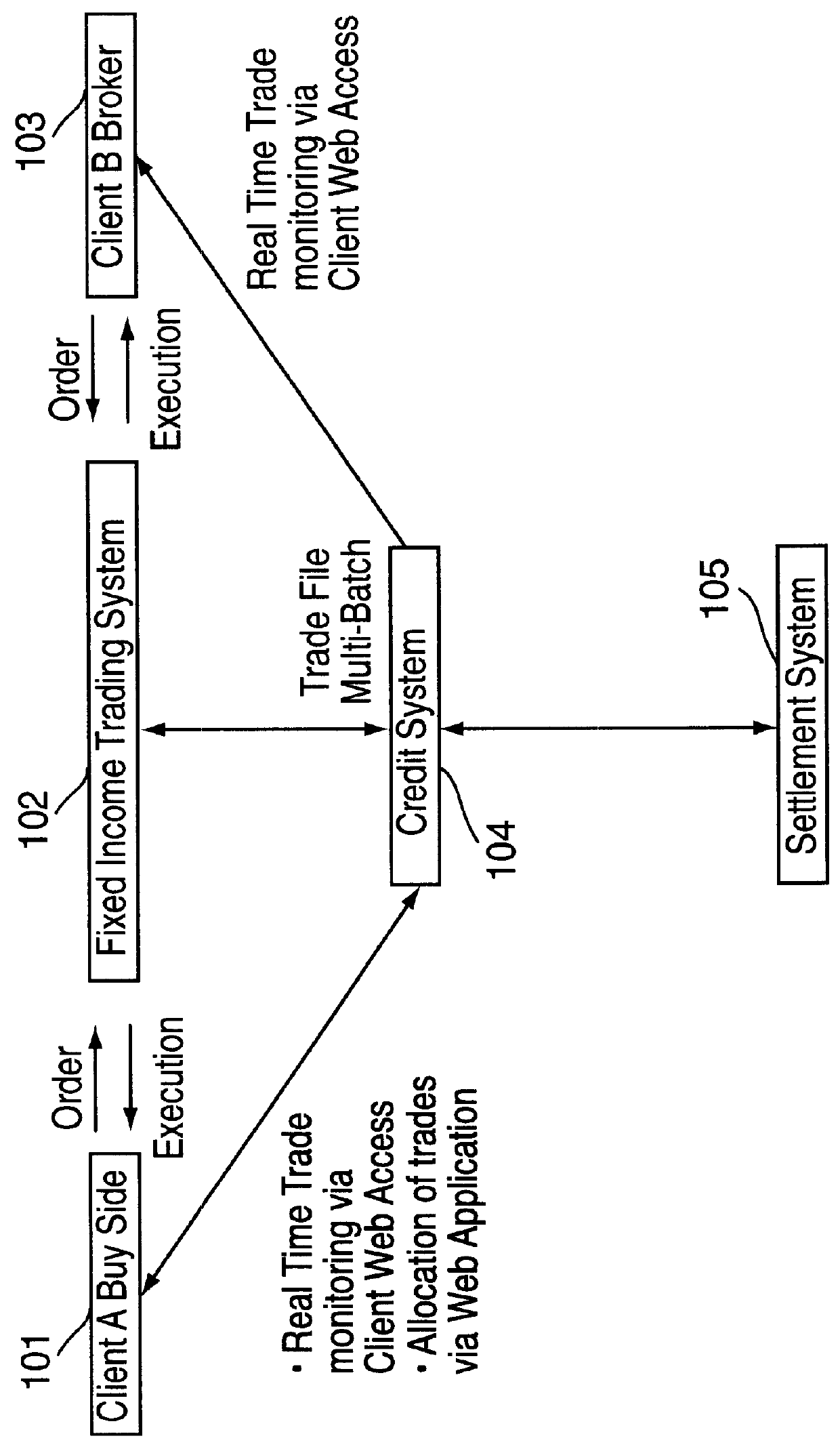

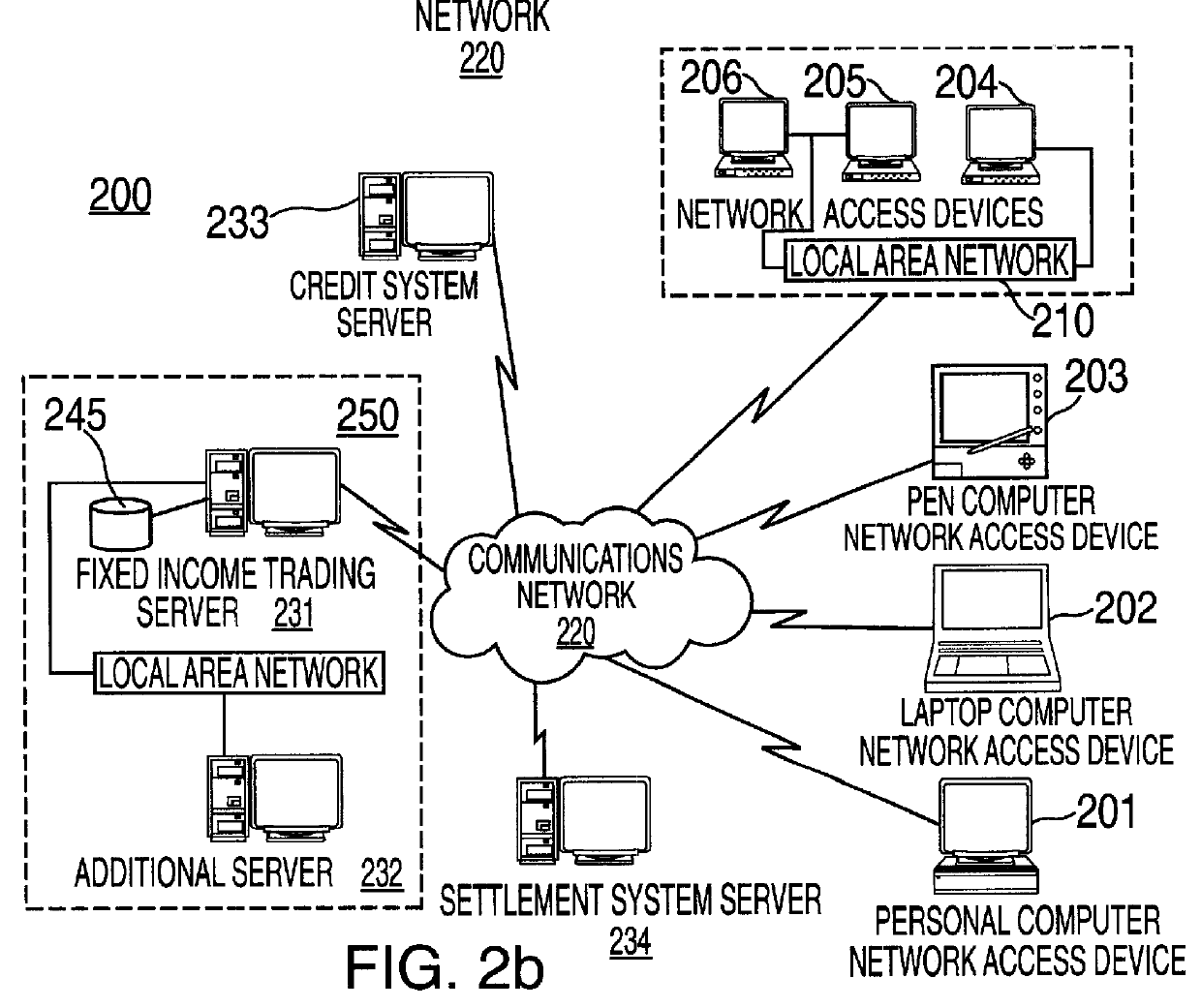

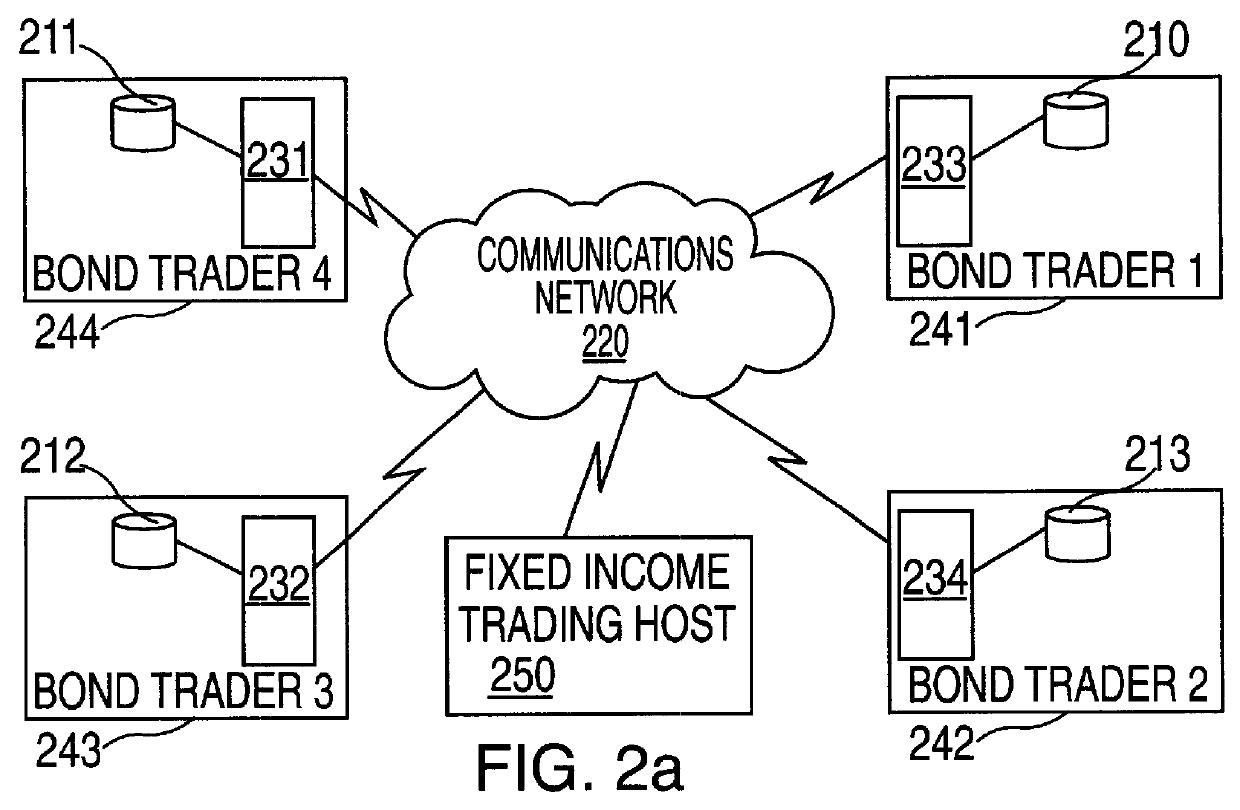

Automated fixed income trading

InactiveUSH2064H1Facilitate fixed income security trading activityFacilitate fixed income security trading activitiesFinanceSpecial data processing applicationsCombined useComputerized system

A method and system is provided for automated trading of fixed income securities which enables institutional investors, broker dealers and others, to transact directly and anonymously for the purpose of trading investment grade, high yield corporate bonds, municipal bonds or other fixed income securities. A financial institution acting as a Fixed Income Securities system sponsor can act as counterparty to transactions, from trade execution through settlement, and can also serve as a credit intermediary. Computer systems are utilized in conjunction with an electronic communications network to facilitate such fixed income security trading activities. Software routines can direct a trader to various fixed income securities available according to specific criteria put forth by the trader. Software routines can also provide information and services related to the automated trading of fixed income securities. Data relating to trading a fixed income security is transmitted from a Fixed Income Trading (FIT) system and information relating to the sale of a fixed income security is received. A live order, based upon the sale information received, can then be executed or transmitted to a point of execution. The live order provides that the FIT system acts as counterparty to each transaction such that a client trader can remain anonymous to a party on the other side of a trade. In this manner, a first trade can be executed between a party selling a fixed income security and the FIT system, and a second trade can be executed between the FIT system and a party purchasing the fixed income security. In addition, the FIT system operators can commit to market liquidity for the fixed income security traded. Numerous types of fixed income securities can be traded, including investment grade, high yield corporate bonds, municipal bonds or other types of securities.

Owner:GOLDMAN SACHS & CO LLC

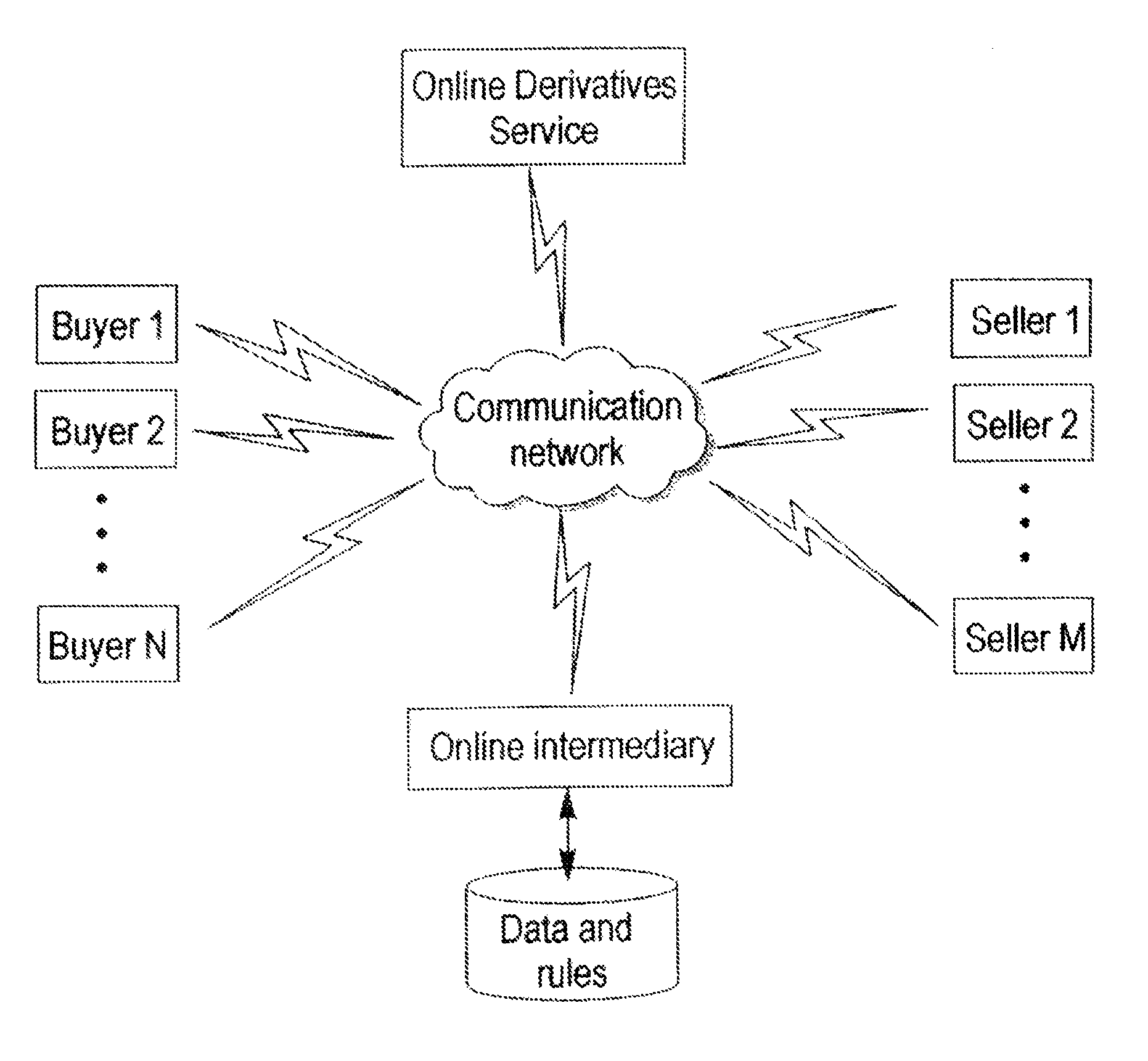

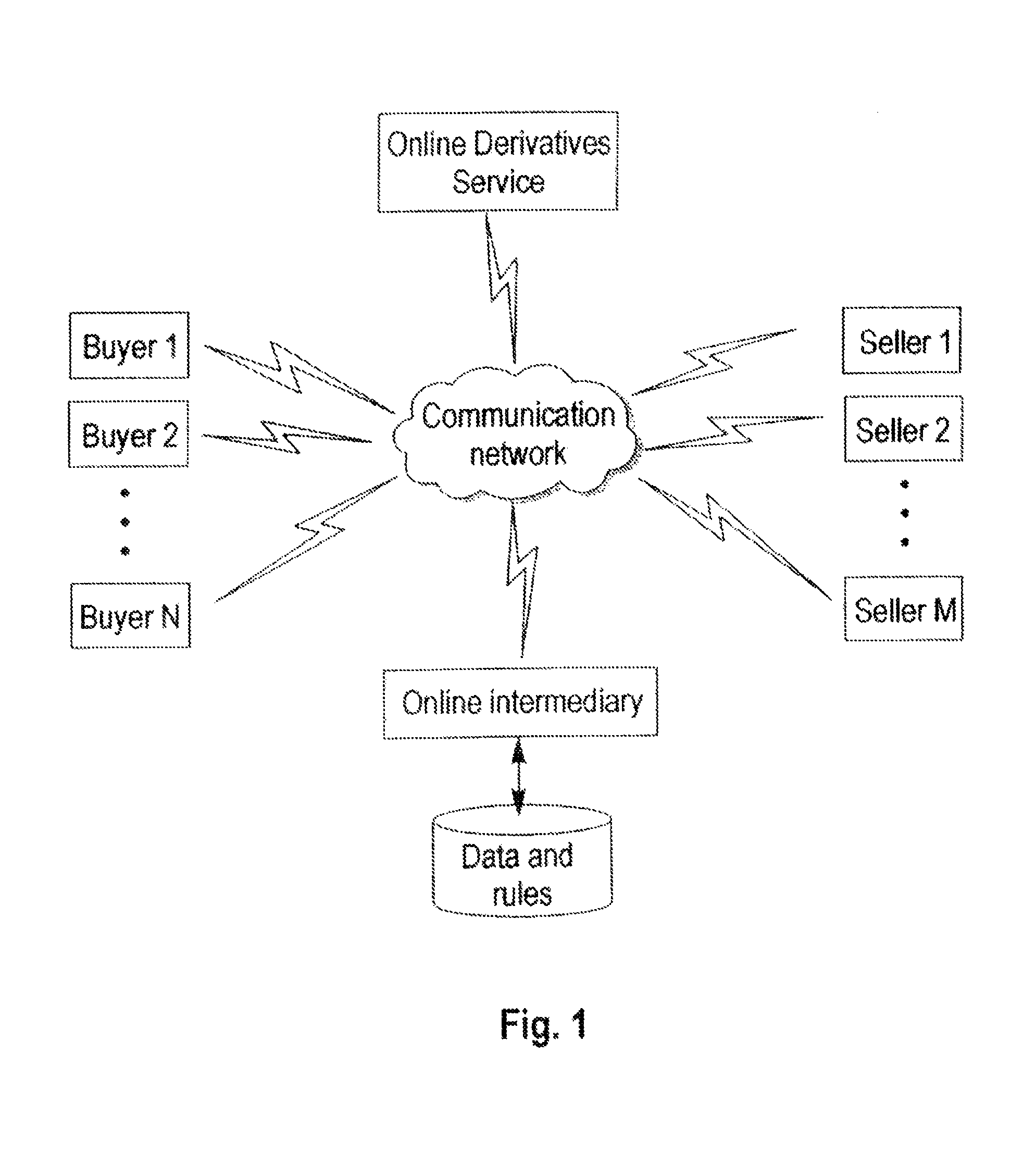

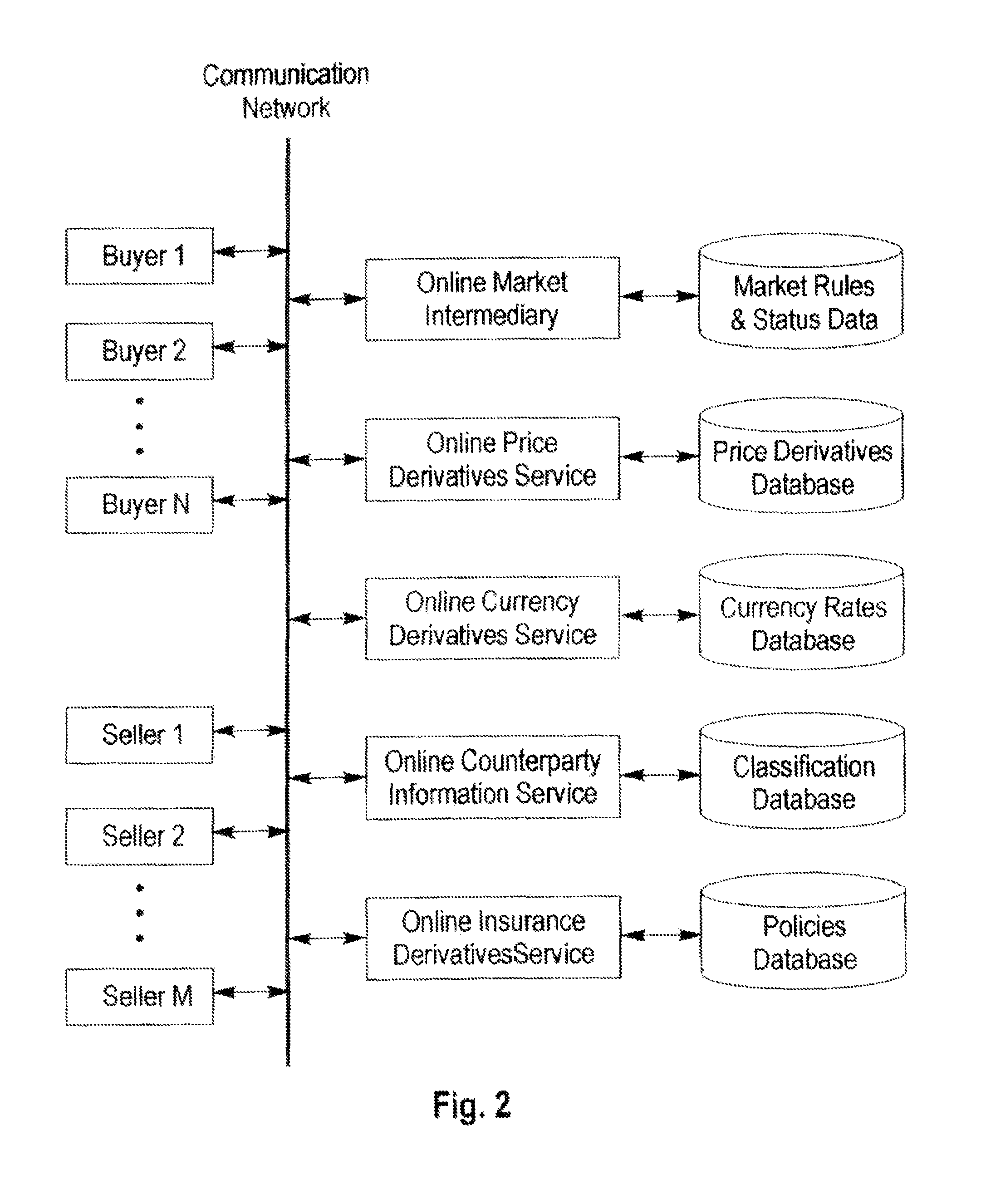

Online e-commerce transactions incorporating effects of uncertainty and risk factors

The present invention relates to a method, system and computer program product for online negotiations and transactions for electronic commerce spanning international boundaries and includes means for incorporating the effects of the associated uncertainties and risks into decisions related to the assignment of items and the determination of their prices and further means for mitigation of some of these uncertainties and risks. These uncertainties and risk may include those originating from price changes, currency fluctuations, counterparty default, non-conformance to quality and quantity specifications and shipment and payment delays.

Owner:INT BUSINESS MASCH CORP

Systems for risk portfolio management

A switch engine module enables anonymous switches between a first trader and a plurality of second traders. The switch engine module receives interest rate risk portfolios from a plurality of traders, and for each prospective trader, provides available switches based on positions in other counterparty portfolios that offset the viewing traders' positions. The offsetting positions are encoded with credit preference information in order to identify eligible trades based on both counterparties credit preferences. The credit preferences of the participating traders can be taken in consideration in making switches.

Owner:BLACKBIRD HLDG

Credit handling in an anonymous trading system

InactiveUS7024386B1Reduce the amount requiredReduce capacityFinancePayment architectureEngineeringCredit limit

In an anonymous trading system, credit between counterparties is effectively increased by netting buy and sell trades to reflect the true risk to which each party is exposed. Credit limits are adjusted by calculating the exposure in each currency at the relevant time and then converted into the credit limit currency equivalent. The credit limits are adjusted accordingly. The resulting credit limits may be different for bids and offers by or from a given counterparty.

Owner:CME GRP

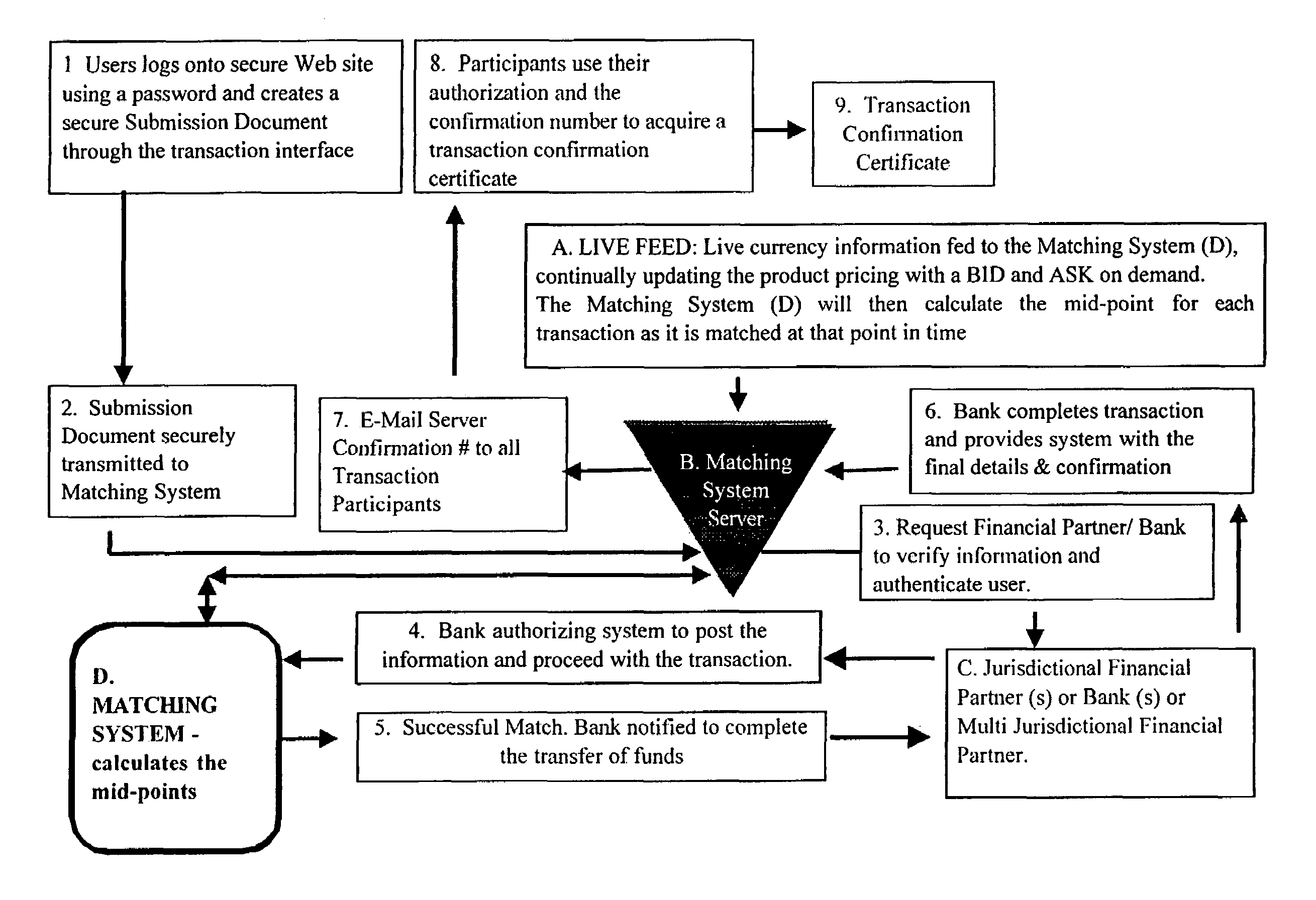

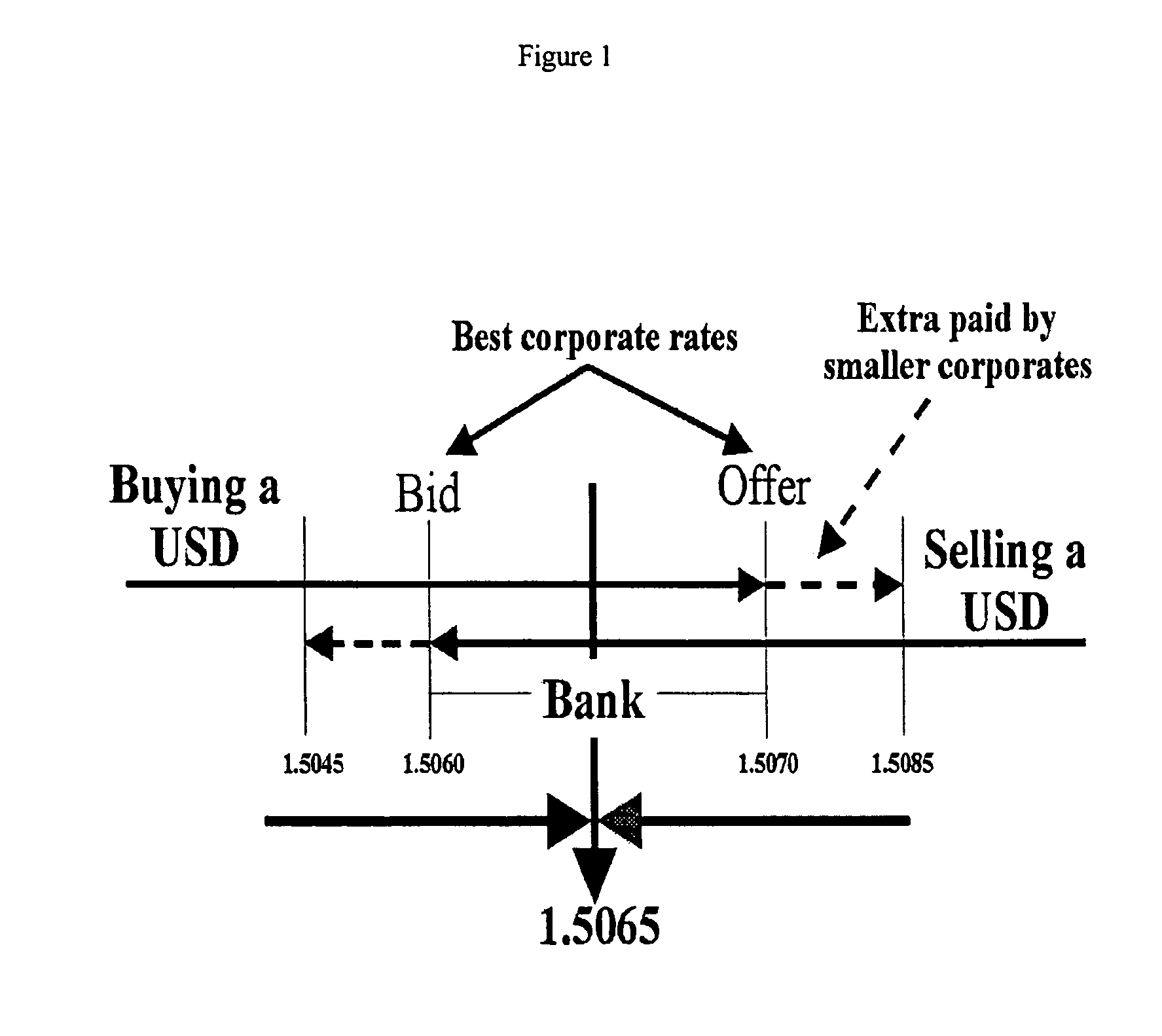

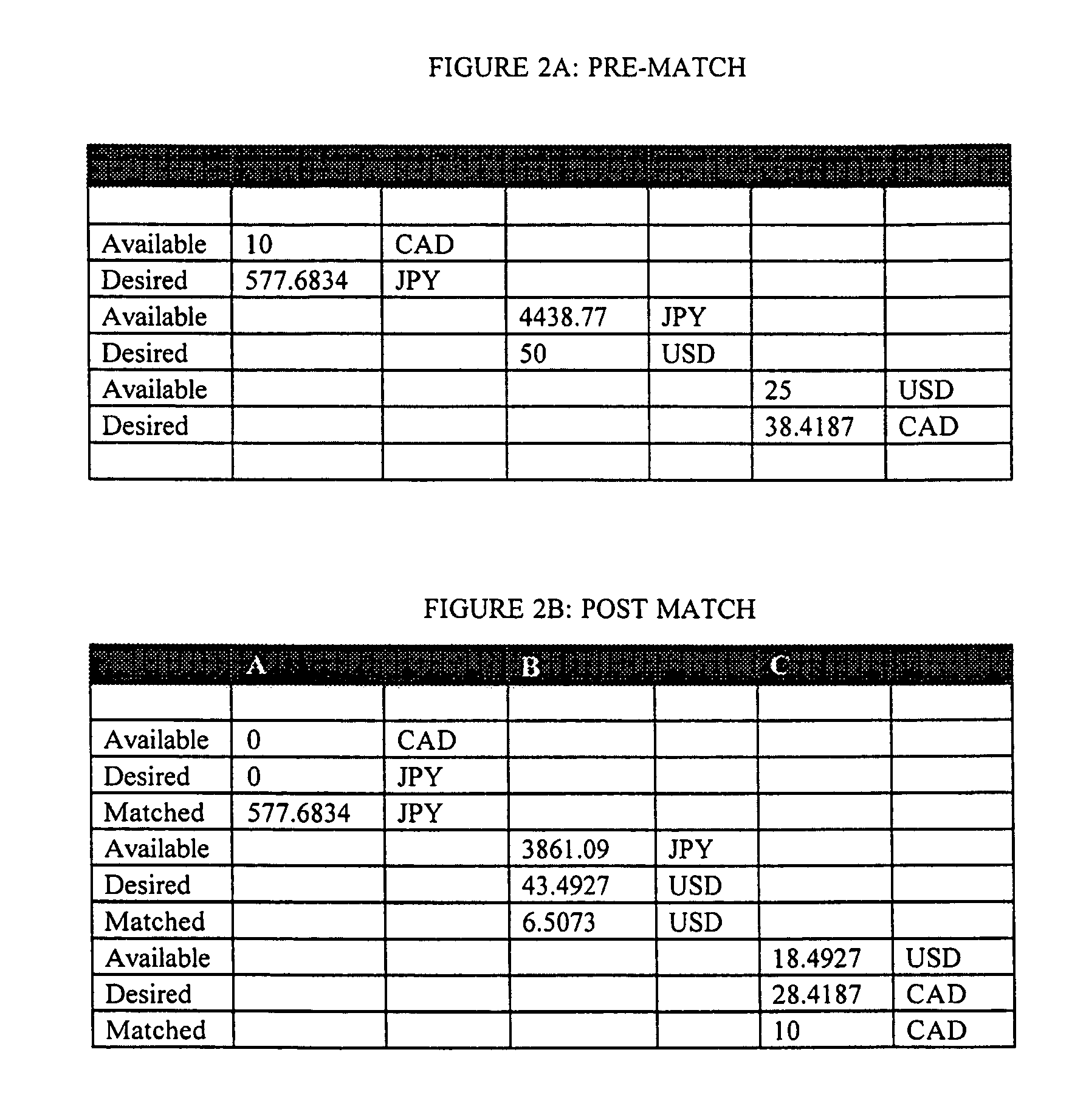

Computer based matching system for party and counterparty exchanges

InactiveUS7194481B1Valid matchDigital data processing detailsBuying/selling/leasing transactionsComputer scienceCounterparty

A computer based system is disclosed which enables a buyer and a seller to be efficiently matched. The system can comprise a web based foreign exchange platform in which parties and counterparties post their requirements. A computer identifies and matches reciprocal, offsetting positions and effects a trade at a price which is the mid-point of the Interbank bid / offer spread. The system is fast, efficient and fair, as well as being significantly cheaper than conventional foreign exchange systems.

Owner:BUYFX COM

Devices, Systems, and Methods for Facilitating Low Trust and Zero Trust Value Transfers

ActiveUS20170187535A1Reliability may occurFinanceUser identity/authority verificationThird partyTransfer Agreement

Devices, systems, and methods enabling parties with little trust or no trust in each other to enter into and enforce value transfer agreements conditioned on input from or participation of a third party, over arbitrary distances, without special technical knowledge of the underlying transfer mechanism(s), optionally affording participation of third-party mediators, substitution of transferors and transferees, term substitution, revision, or reformation, etc. Such value transfers can occur reliably without involving costly third-party intermediaries who traditionally may otherwise be required, and without traditional exposure to counterparty risk.

Owner:VERITASEUM

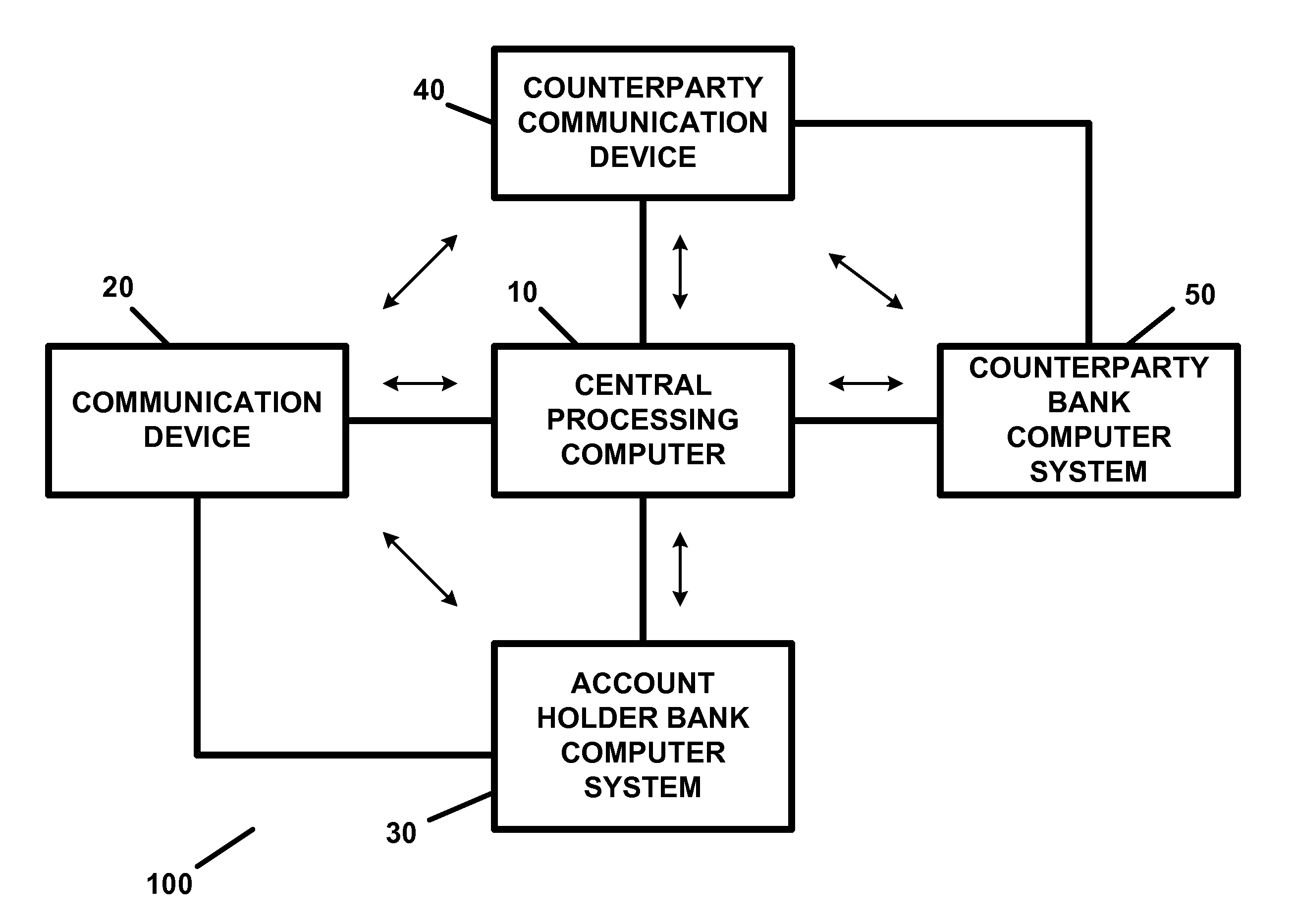

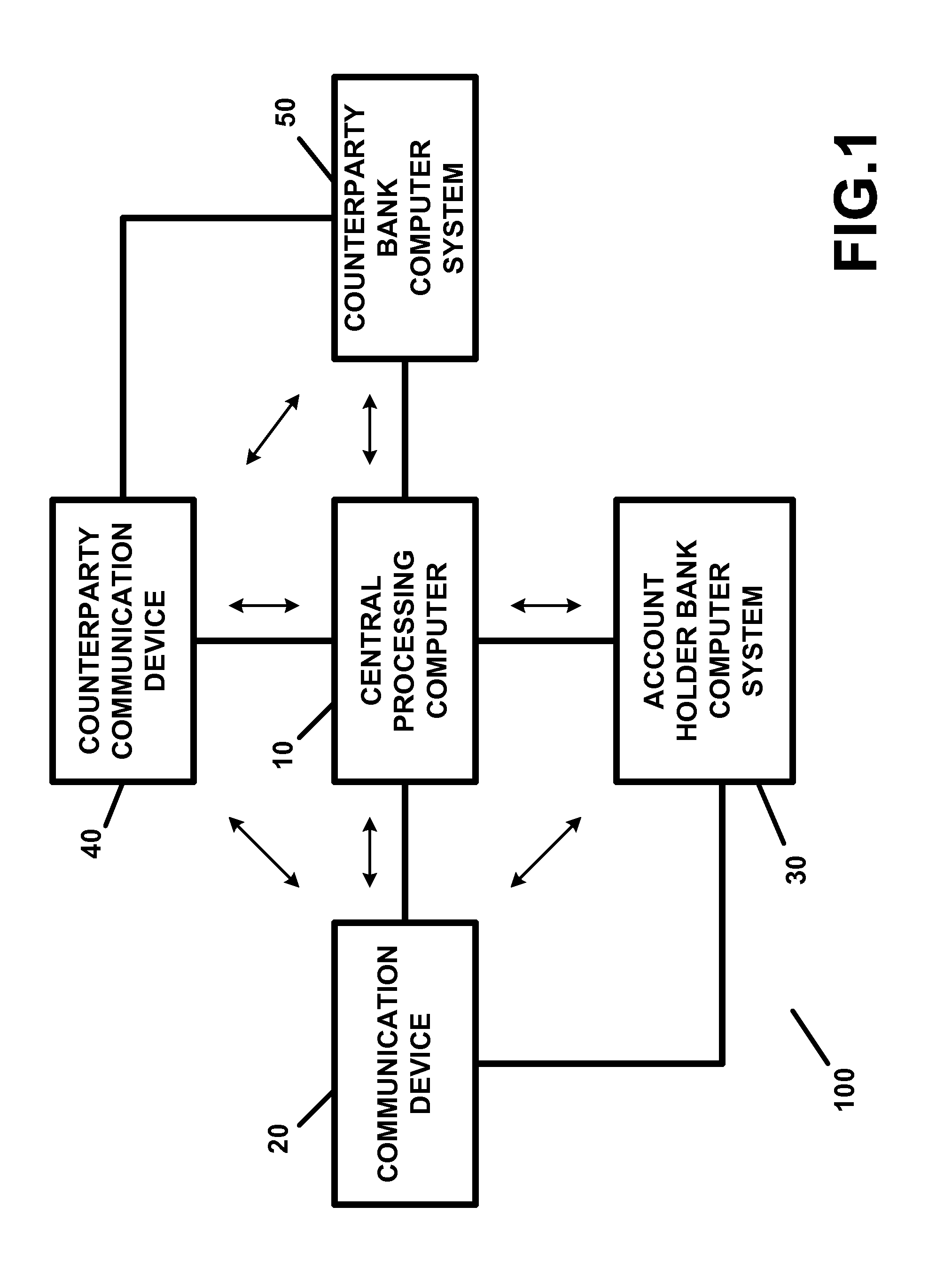

Apparatus and method for providing transaction security and/or account security

InactiveUS20150012417A1Reduce threatEasy accessFinancePayment protocolsTelecommunications linkInternet privacy

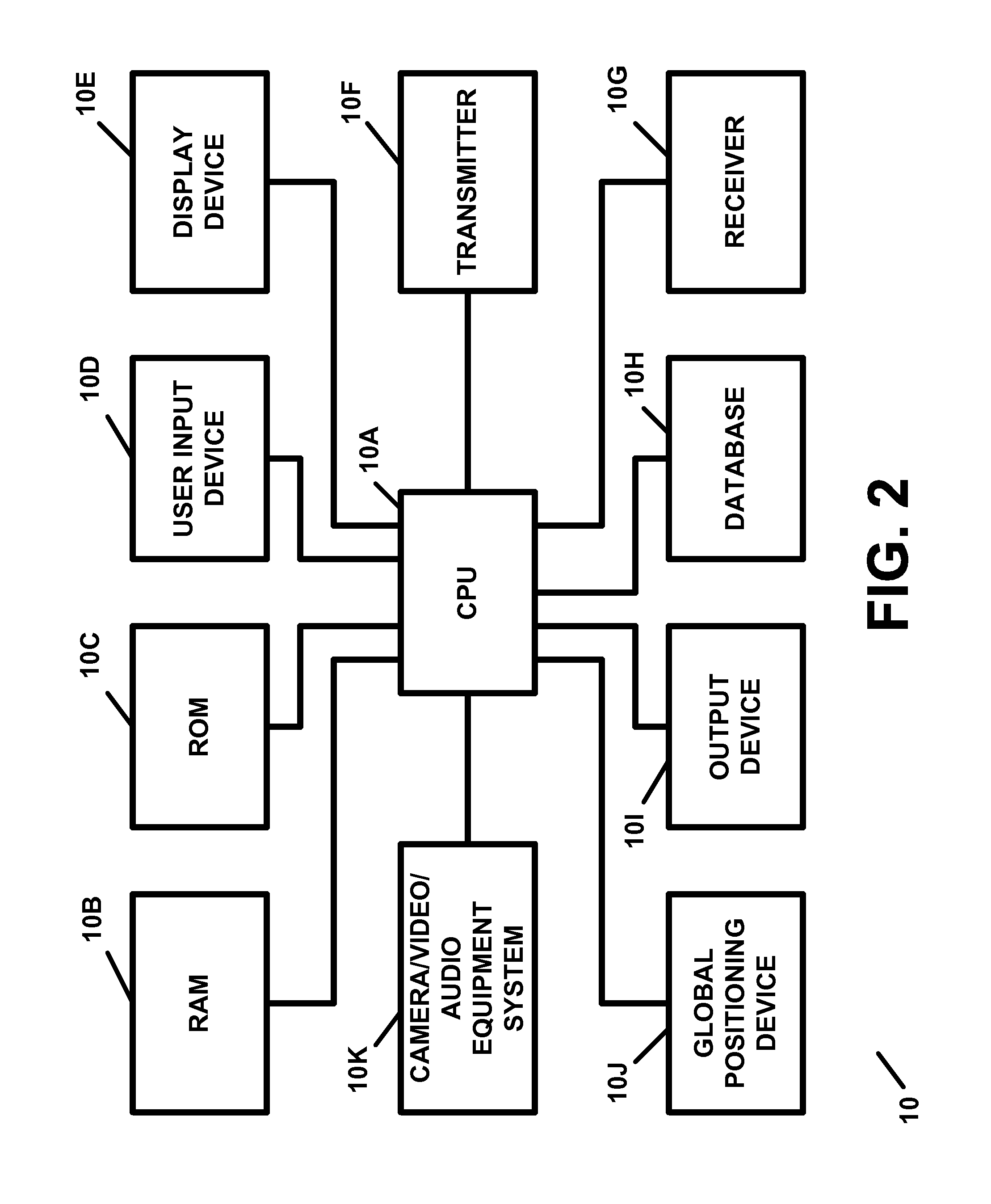

A transaction security apparatus, including a memory device for storing information regarding an account of or associated with an account holder, an input device or a receiver for inputting or for receiving transaction information regarding a transaction between the account holder and a counterparty, wherein the transaction is an in-person transaction or a face-to-face transaction, and wherein the transaction information includes information regarding the counterparty, information regarding an amount of the transaction, and information for accessing a communication device associated with the counterparty, a processing device, wherein the processing device processes the transaction information and generates a message containing information regarding the account, and further wherein the apparatus establishes a communication link with the communication device, and a transmitter, wherein the transmitter transmits the message to the communication device on, over, or via the communication link.

Owner:JOAO RAYMOND ANTHONY +1

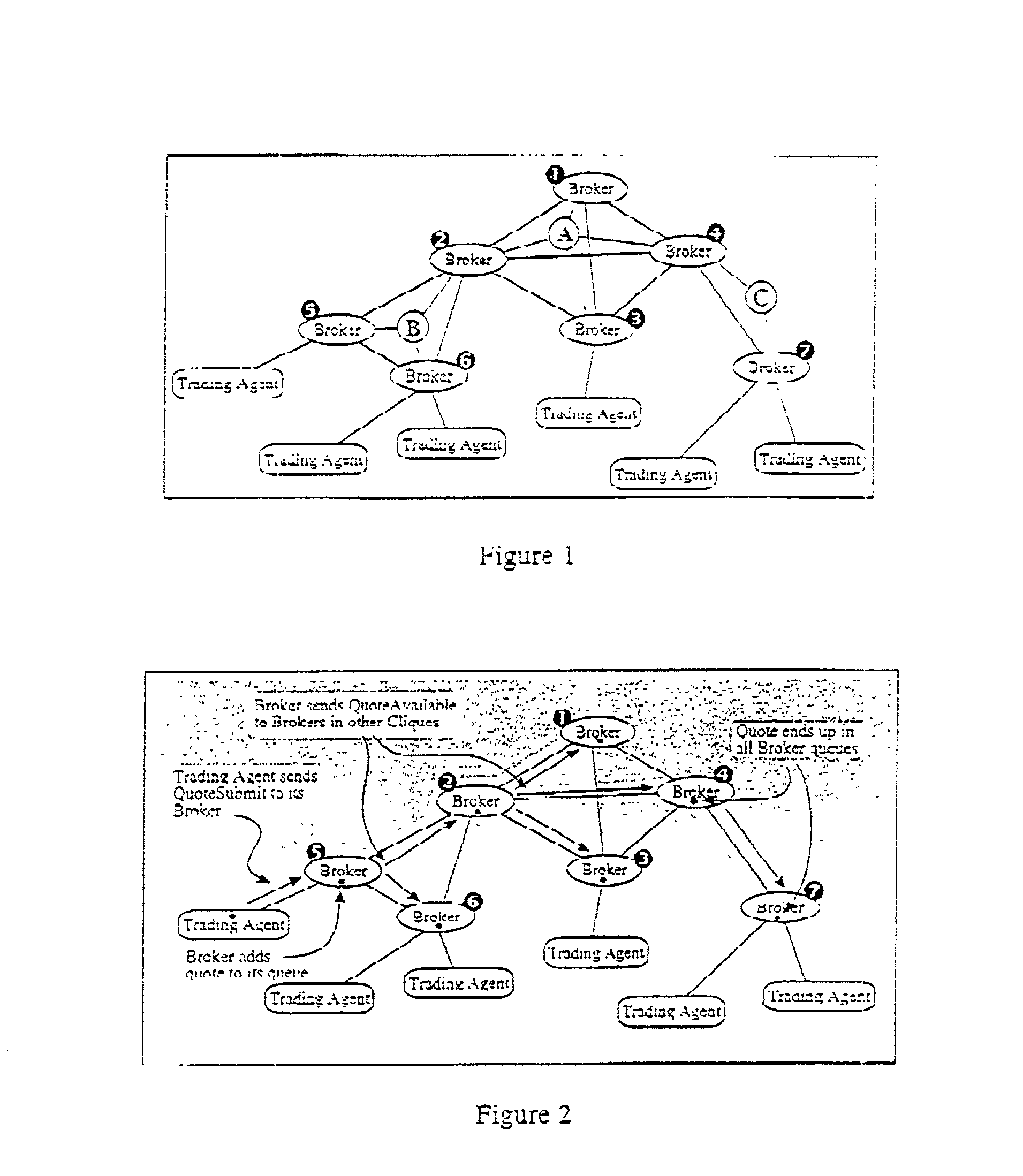

Price display in an anonymous trading system

InactiveUS20050283426A1Avoiding unnecessary messageReduce system performanceFinanceSpecial data processing applicationsRequest for quotationComputer science

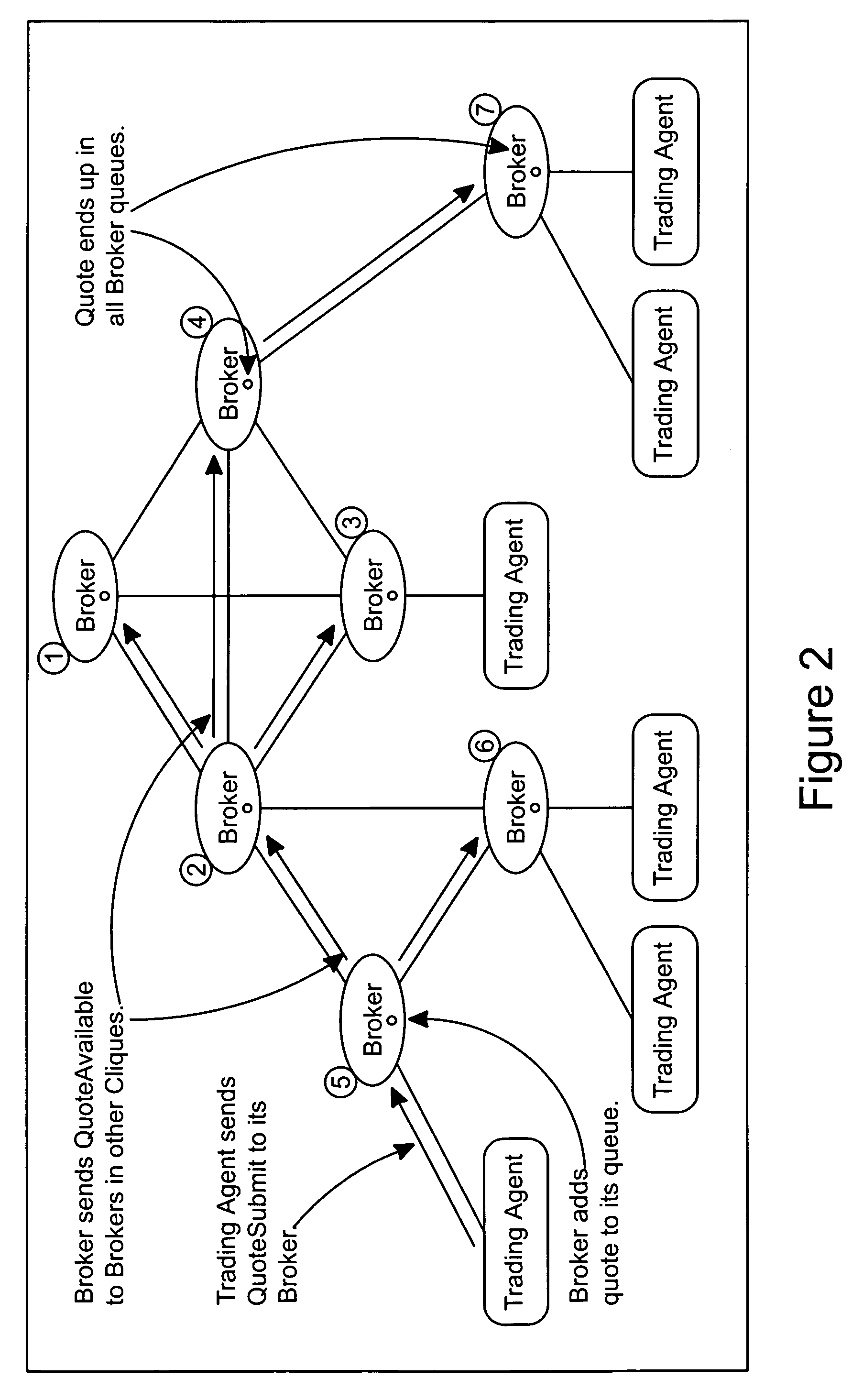

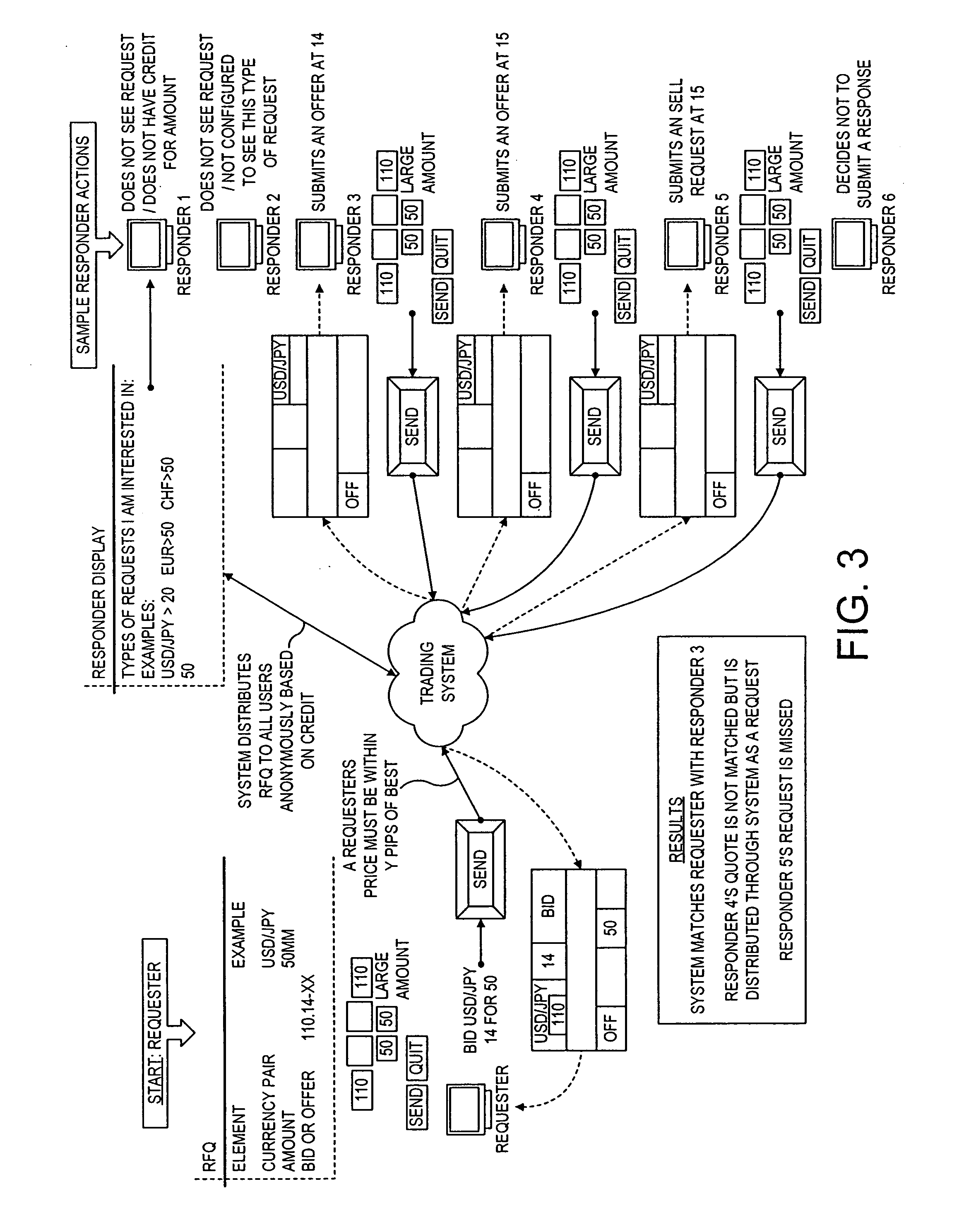

An anonymous trading system comprises an interconnected network of broking nodes arranged in cliques which receive buy and sell orders from trader terminals via connected trading engines and which match persistent orders, executed deals and distribute price information to trader terminals. The system has the ability for a trader to call out for a quote (request for a quote) anonymously. RFQs are only transmitted on to potential counterparties if they are within a predetermined price range. The RFQs include a price at which the requesting party is willing to deal, but this price is not communicated potential counterparties. Counterparty responses are matches on a time, price basis and non-matched responses may be matched with themselves. Similarly, non-matched RFQs may be matched with each other.

Owner:EBS GROUP +1

Systems and methods for reverse auction of financial instruments

An anonymous trading system which enables derivative dealers to setup credit preferences based upon their own models and provides counterparties, end-users and dealers with the option of choosing to remain anonymous during a derivative trading bidding process. Additionally, the systems and methods restrict derivative trading activity with counterparties where there is an existing banking relationship. Using the system and methods, end-users will be able to obtain prices from multiple dealers without the problems inherent in using a voice-based system by utilizing an electronic reverse auctioning process to anonymously obtain derivative trading bids simultaneously from one or many participating derivative dealers.

Owner:GFINET INC

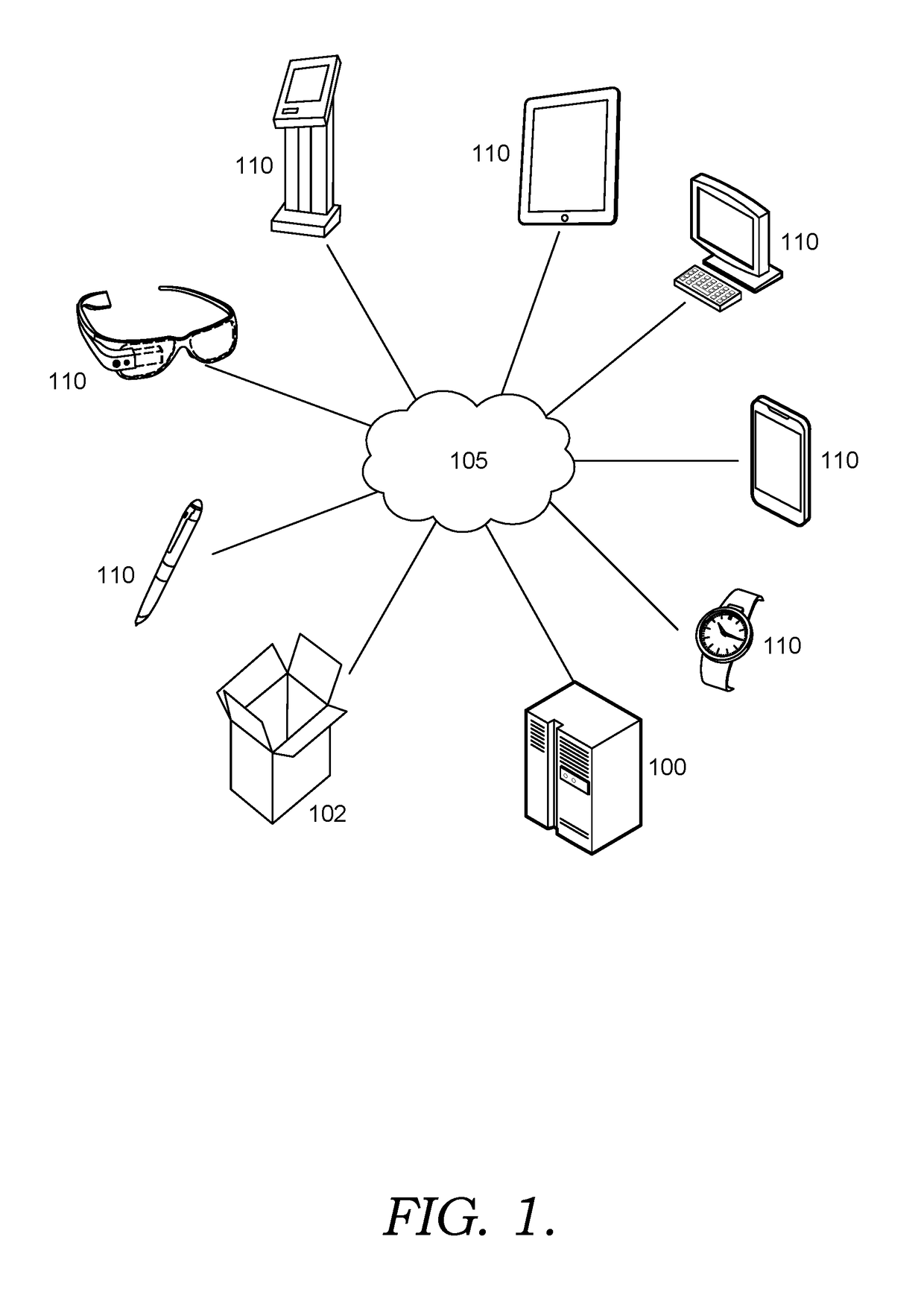

Counterparty physical proximity verification for digital asset transfers

PendingUS20190019144A1Increase heightOvercome deficienciesCryptography processingUser identity/authority verificationDigital assetCounterparty

Embodiments are provided for verifying physical proximity of counterparties in digital asset transfers. A sender device receives a recipient hash and a recipient address are received, where recipient hash is generated by the recipient device based on each of the associated recipient address and a first set of location parameters. The sender device obtains a second set of location parameters that corresponds to a detected physical location thereof. The sender device employs the obtained second set of location parameters to decipher the recipient hash, and generates a request to transfer a digital token from a sender address associated with the sender device to the recipient address based on a determination that the deciphered recipient hash corresponds to the received recipient address.

Owner:UNITED PARCEL SERVICE OF AMERICAN INC

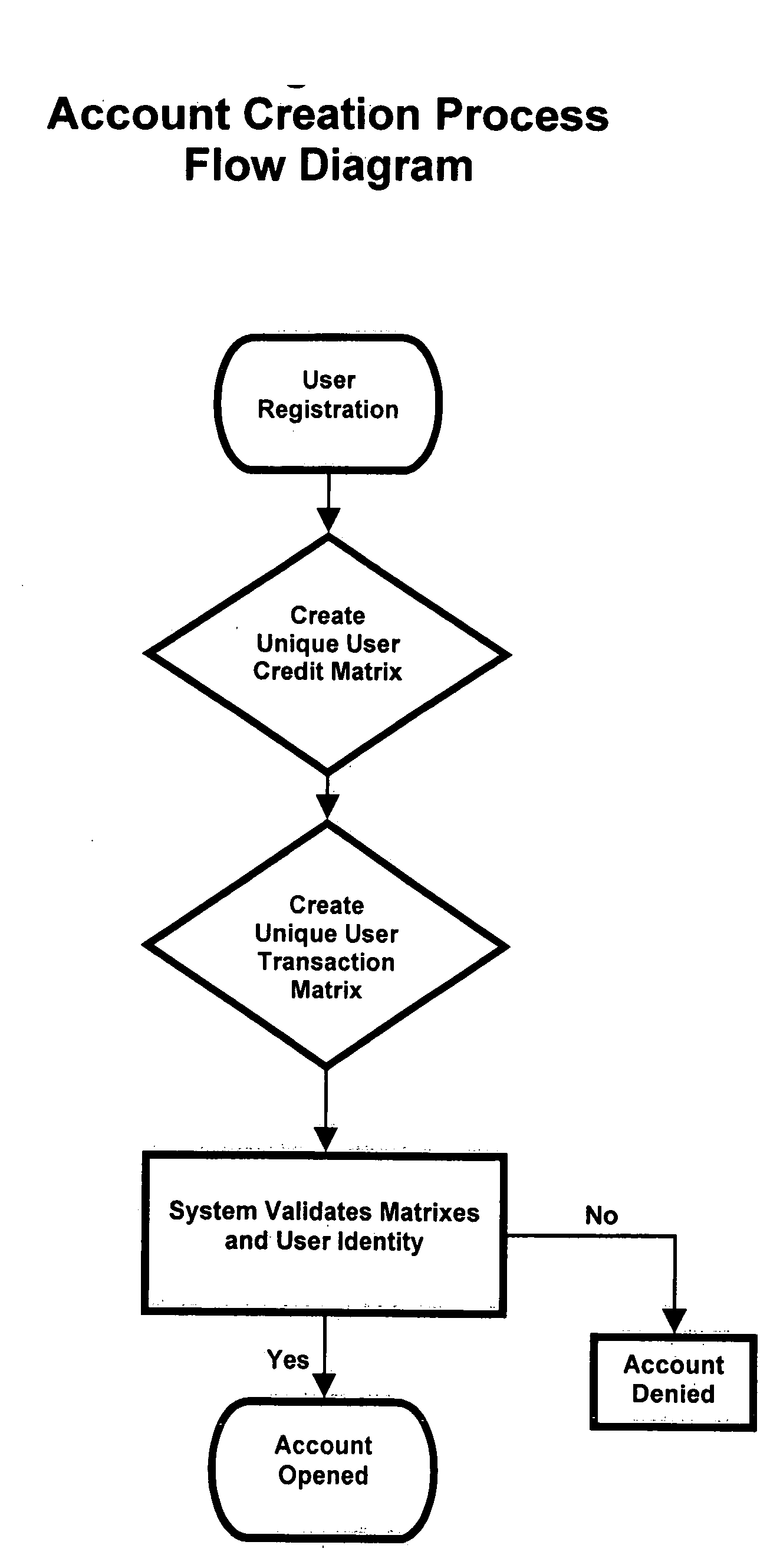

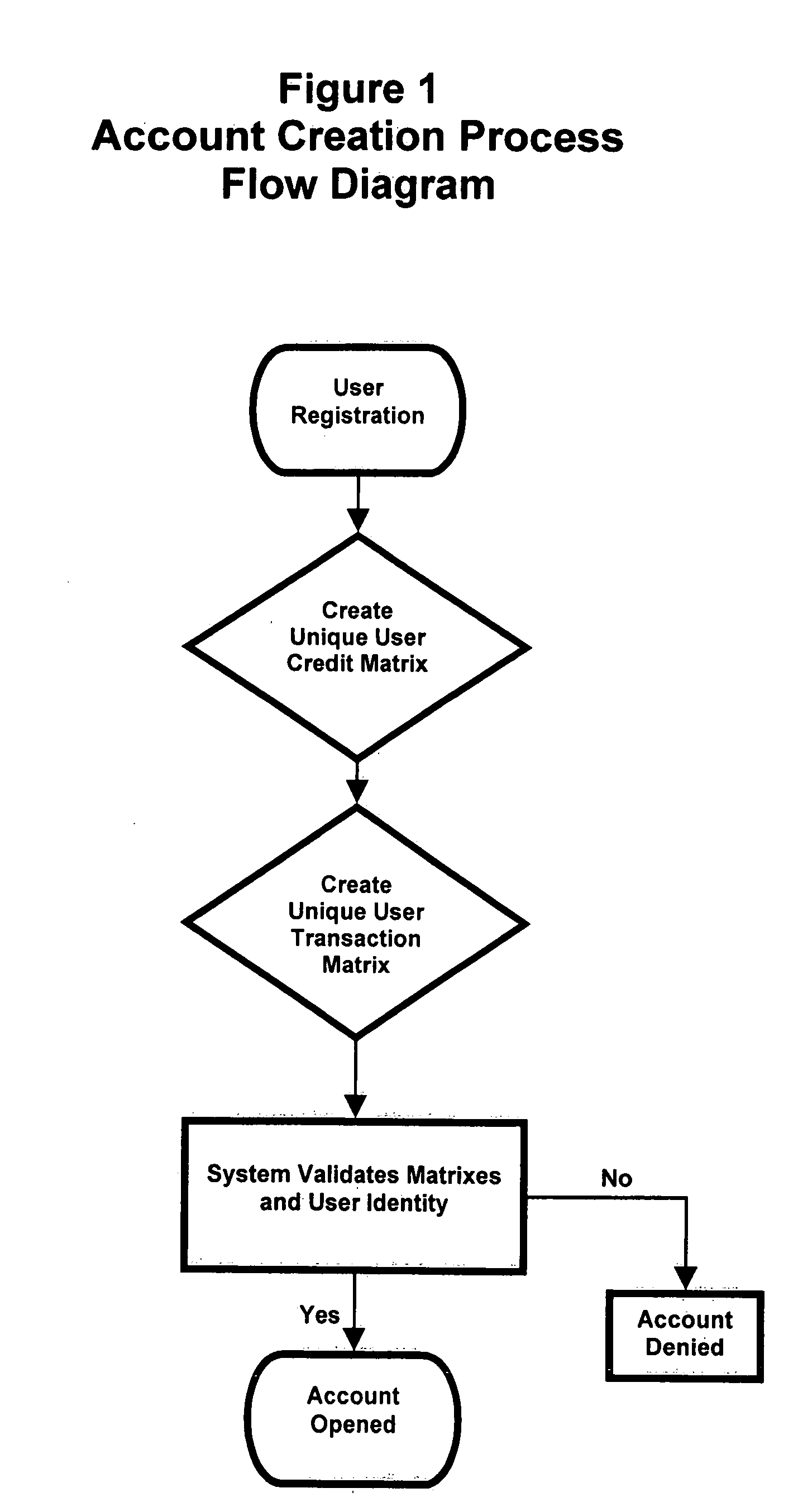

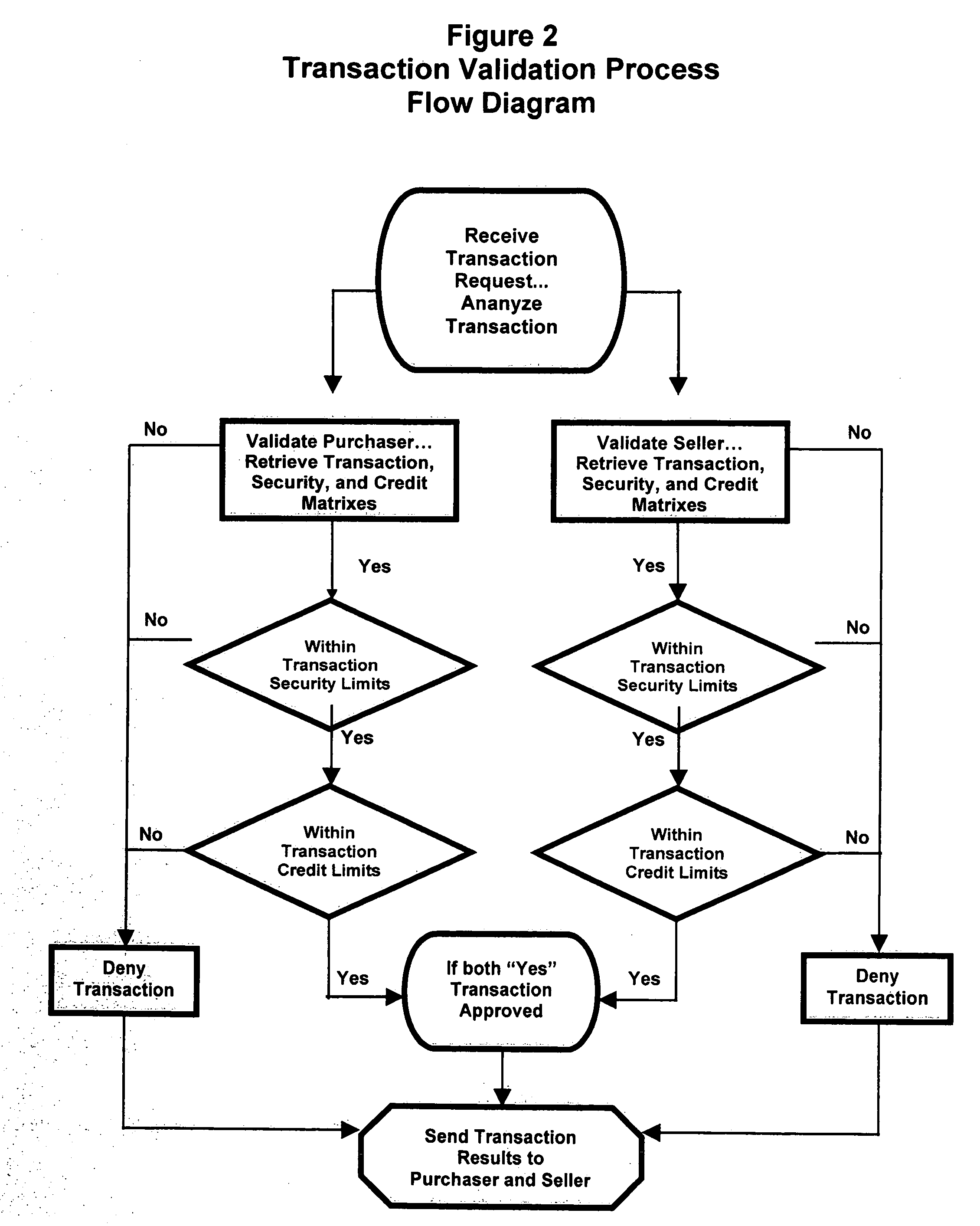

Mobile payment and accounting system with integrated user defined credit and security matrixes

InactiveUS20080255993A1Improve securityFinanceProtocol authorisationThe InternetFinancial transaction

A platform that accommodates financial transactions and is accessible via mobile phone networks, Internet and traditional methods is linked to user defined credit and security matrixes. Credit risk tolerance factors consider the qualifications, characteristics, and profile of counterparties. Security risk tolerance factors consider the user's willingness to use a particular financial platform in an environment where abuse, fraud, theft, and other security factors are of concern. In both cases the user creates matrixes that describe risk tolerance and financial transactions must successfully pass through the filters designed by the user. The system can be used alone or linked to bank accounts, credit and debit accounts, etc. This provides a higher level of security and risk control in a mobile or Web-based environment. By giving customers way to control risk, use of new electronic methods of payment and other financial transactions can be accommodated in a more comfortable, secure, and efficient manner.

Owner:BLINBAUM JACQUES

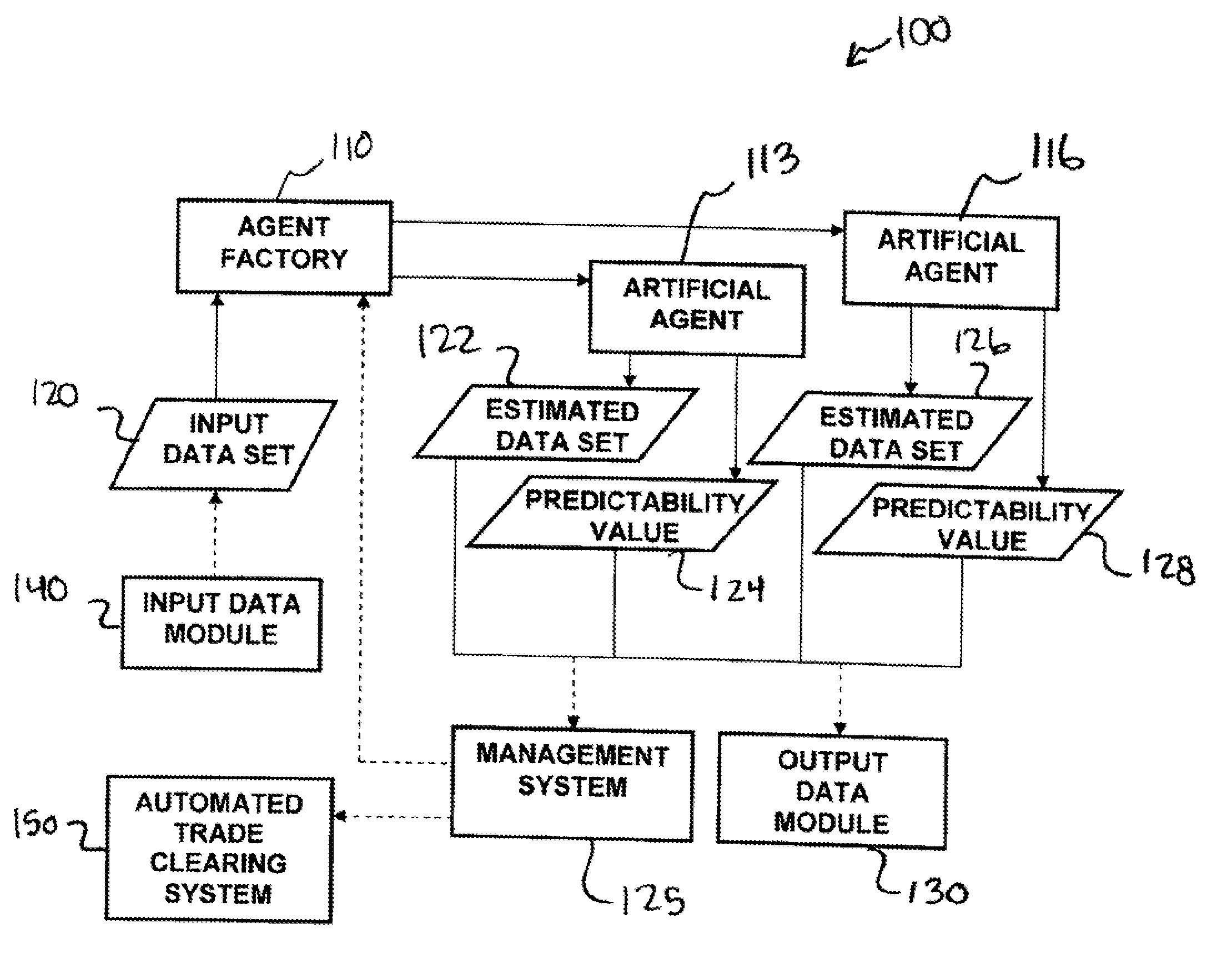

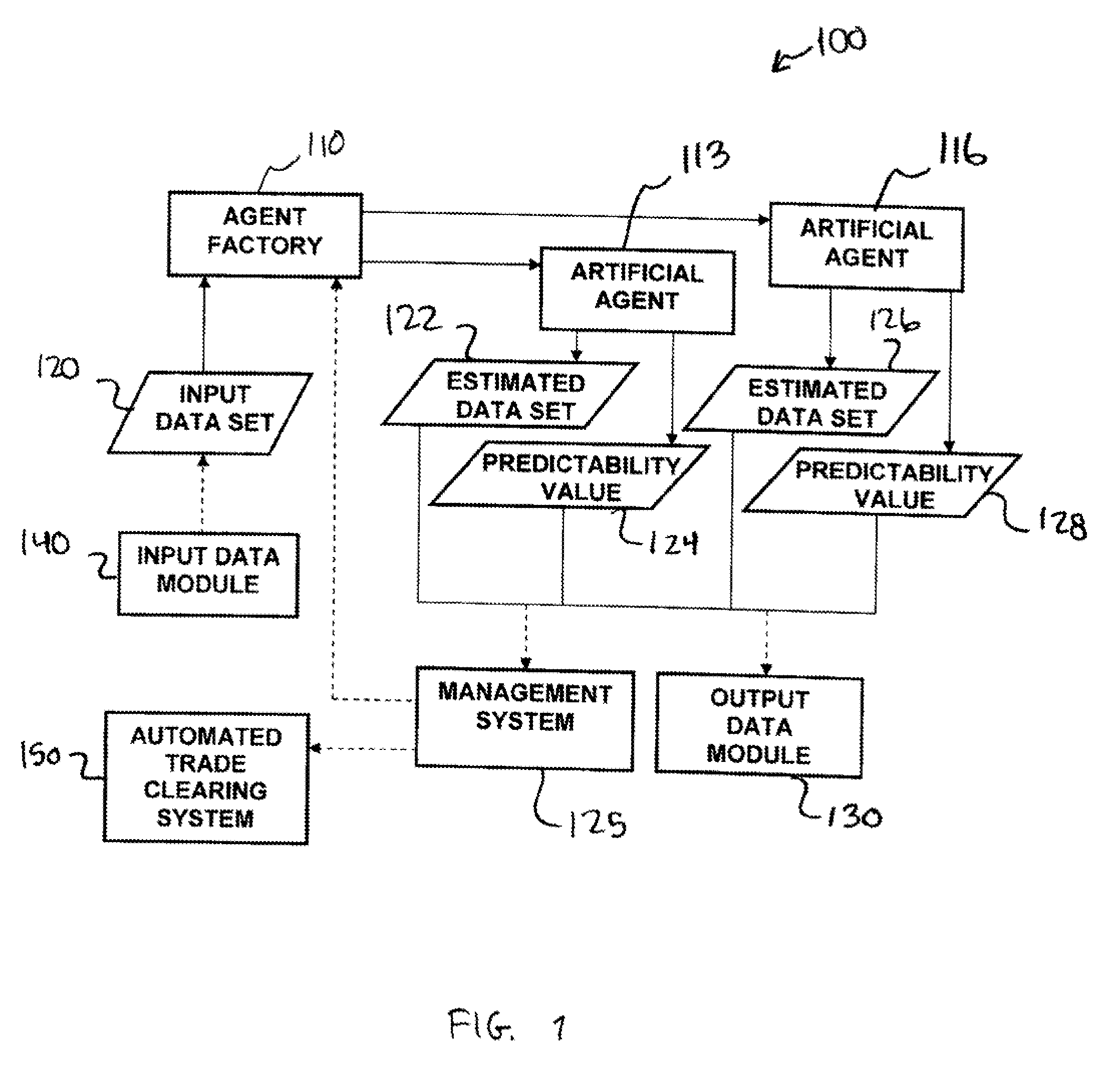

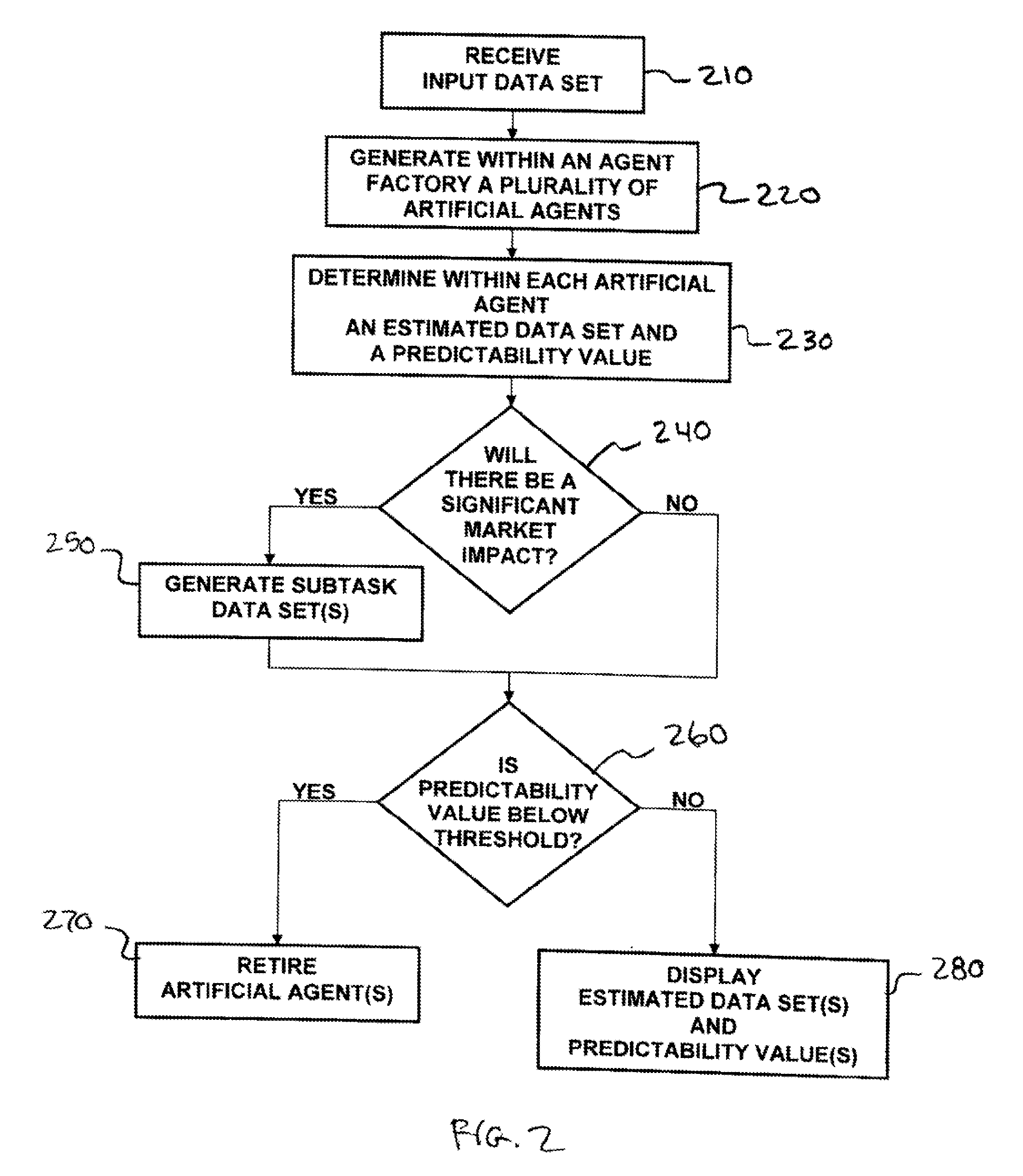

Methods and apparatus for self-adaptive, learning data analysis

Methods and apparatus for analyzing financial data generally includes a predictive modeling system. The predictive modeling system may include an artificial agent responsive to an input data set. The artificial agent may produce an estimated data set including a market conditions data set. The market conditions data may include an estimate of at least one of liquidity of a market, strategy of a counterparty, and an effect of information leakage. The artificial agent may determine a predictability value for the estimated data set. The predictive modeling system may also include an agent factory responsive to the input data set. The agent factory may generate an artificial agent in response to the input data set.

Owner:ADAPTIV TECH

Limiting Counter-Party Risk in Multiple Party Transactions

InactiveUS20080071664A1Minimizing and eliminating counterparty riskReduce the possibility of errorFinanceMedicineFinancial transaction

A computerized entity, system and method for limiting or eliminating counterparty risk for settlement in financial transactions are described. A central counterparty novates trades between counterparties and interposes itself as the entity with whom each counterparty will settle. The central counterparty may require additional credit or collateral from one or more counterparties to ensure that the central counterparty does not assume an unaddressed risk.

Owner:CHICAGO MERCANTILE EXCHANGE INC +1

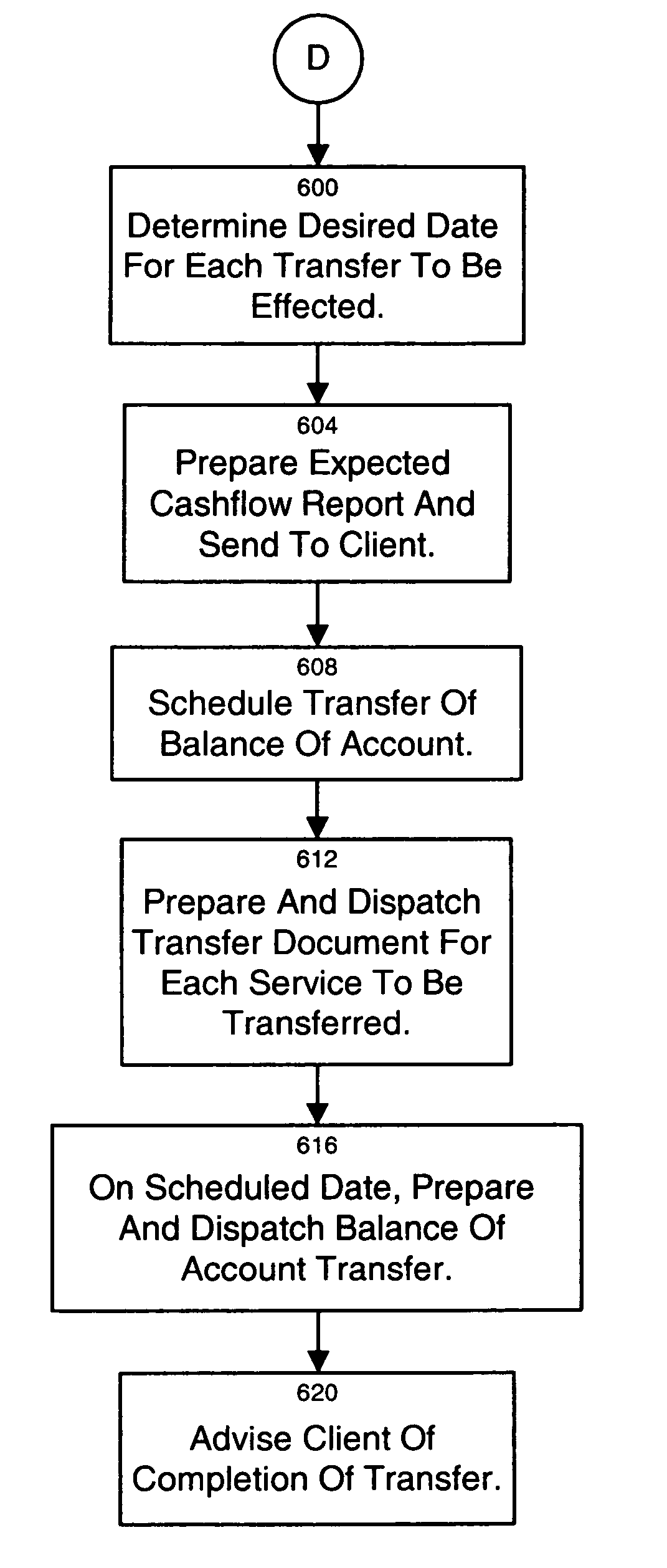

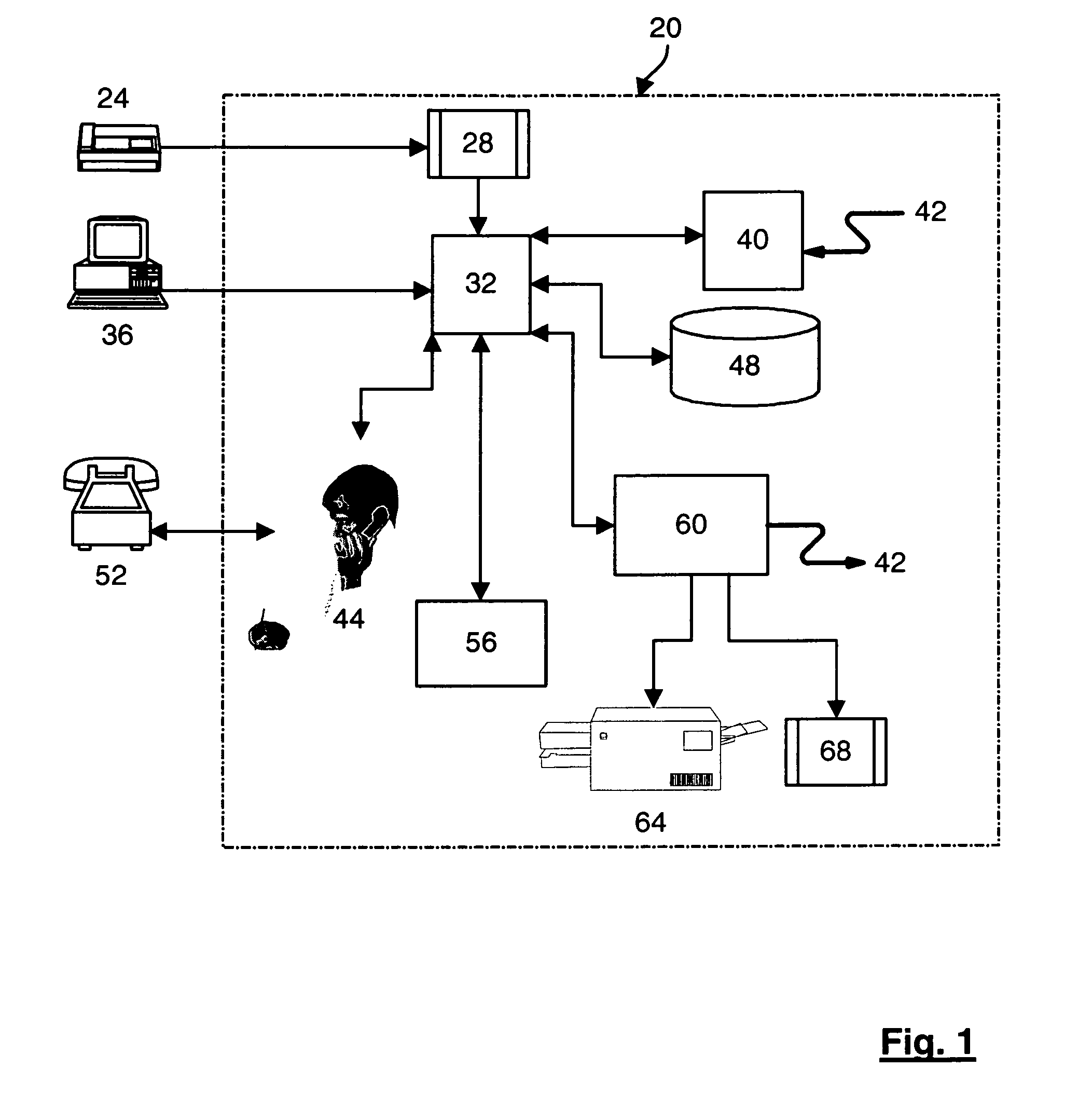

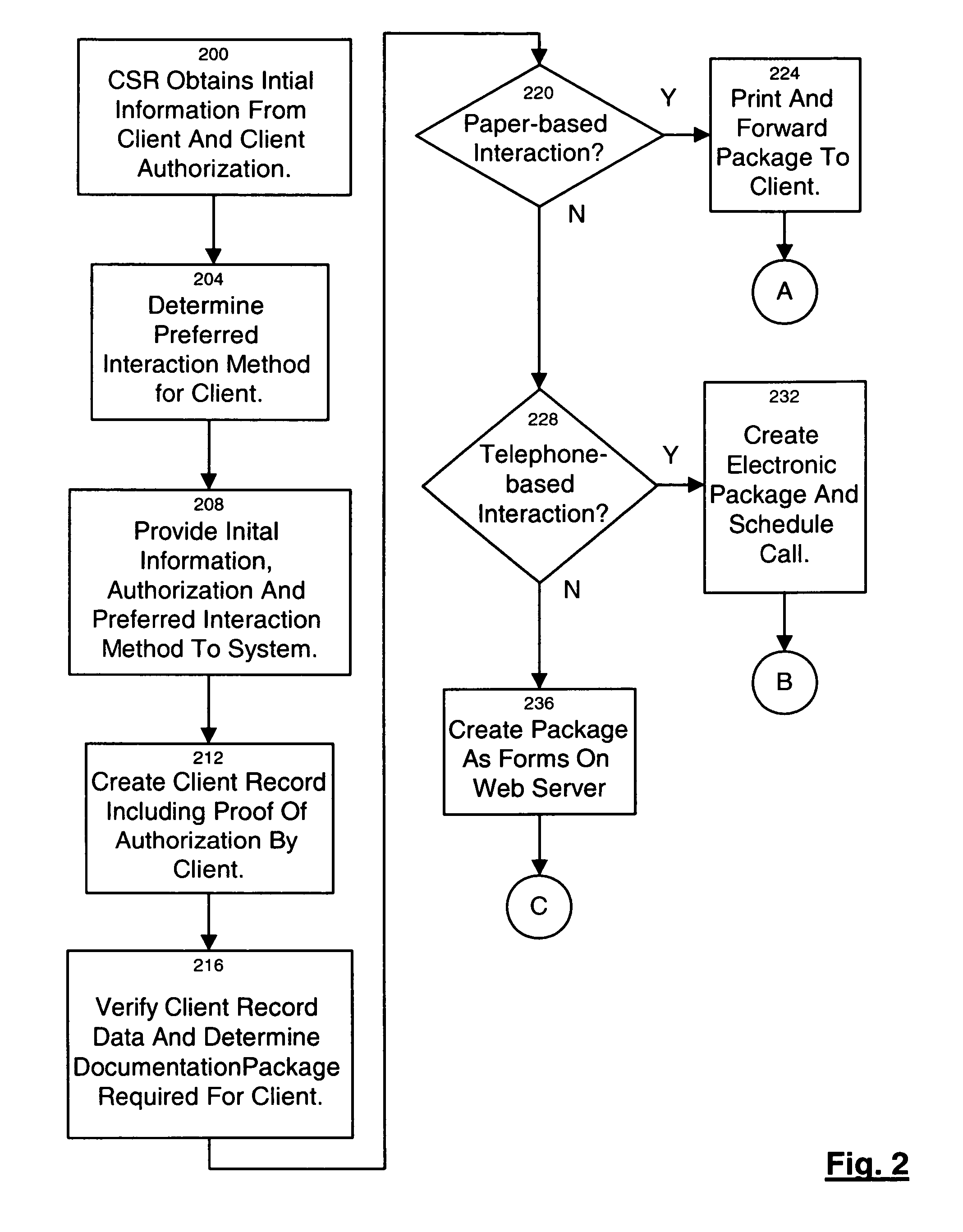

Method and system for assisting a client in the transfer of usage of accounts at one or more financial institutions

A system and method of assisting a client transfer financial services using a first account to a second account collects relevant information and authorization from the client. The system and method maintains a database of counterparties providing services to clients of financial institutions and uses the information provided by the client and information in the database of counterparties to schedule and effect the transfer of the services. The system and method creates the necessary transfer information for each service to be transferred and dispatches the completed transfer information to each counterparty with a desired date for the transfer to be effected, the desired dates being selected in accordance with a cashflow analysis performed by the system and method of both the account at the previous financial institution and the account at the new financial institution.

Owner:DH SOFTWARE CORP

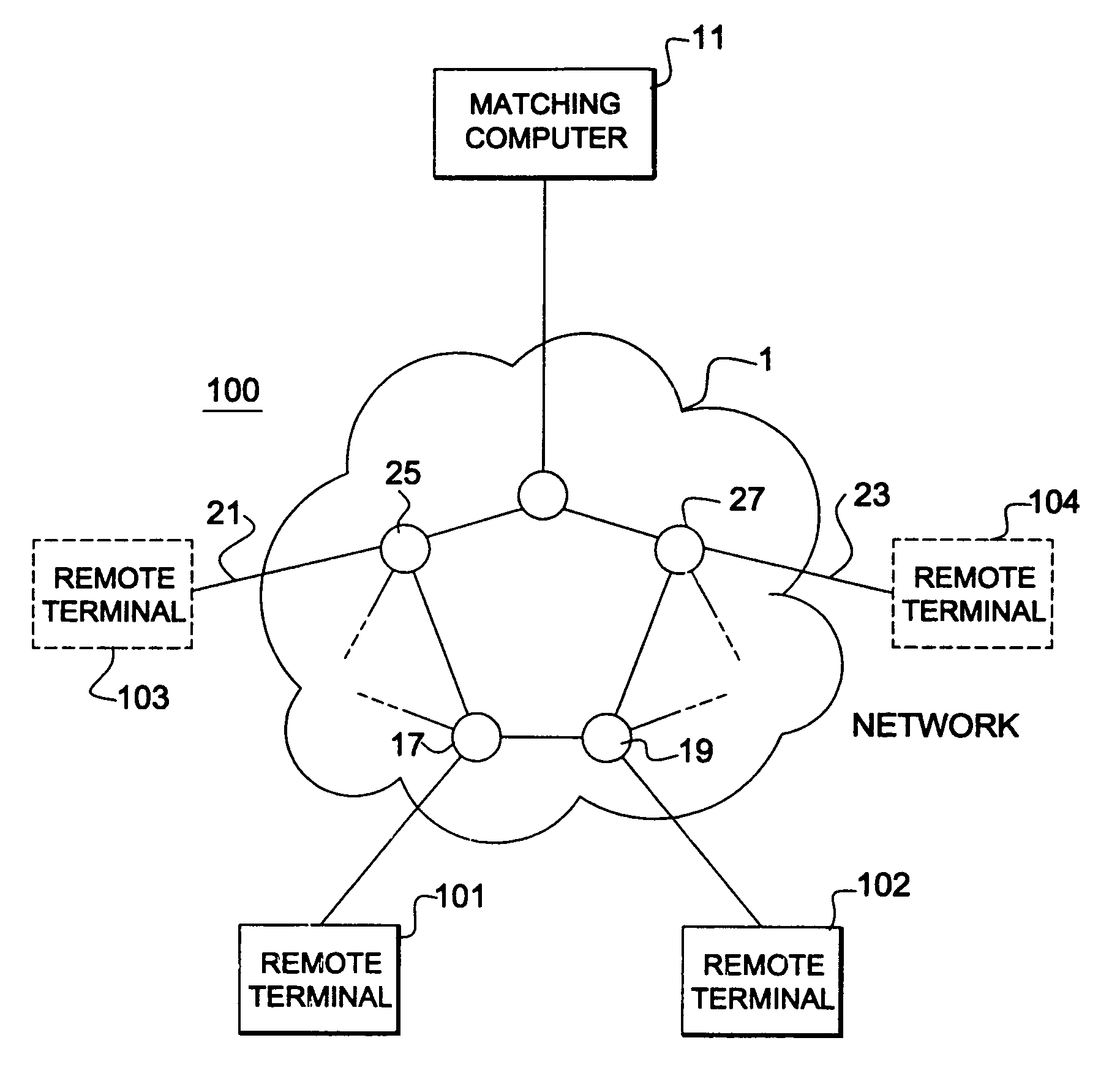

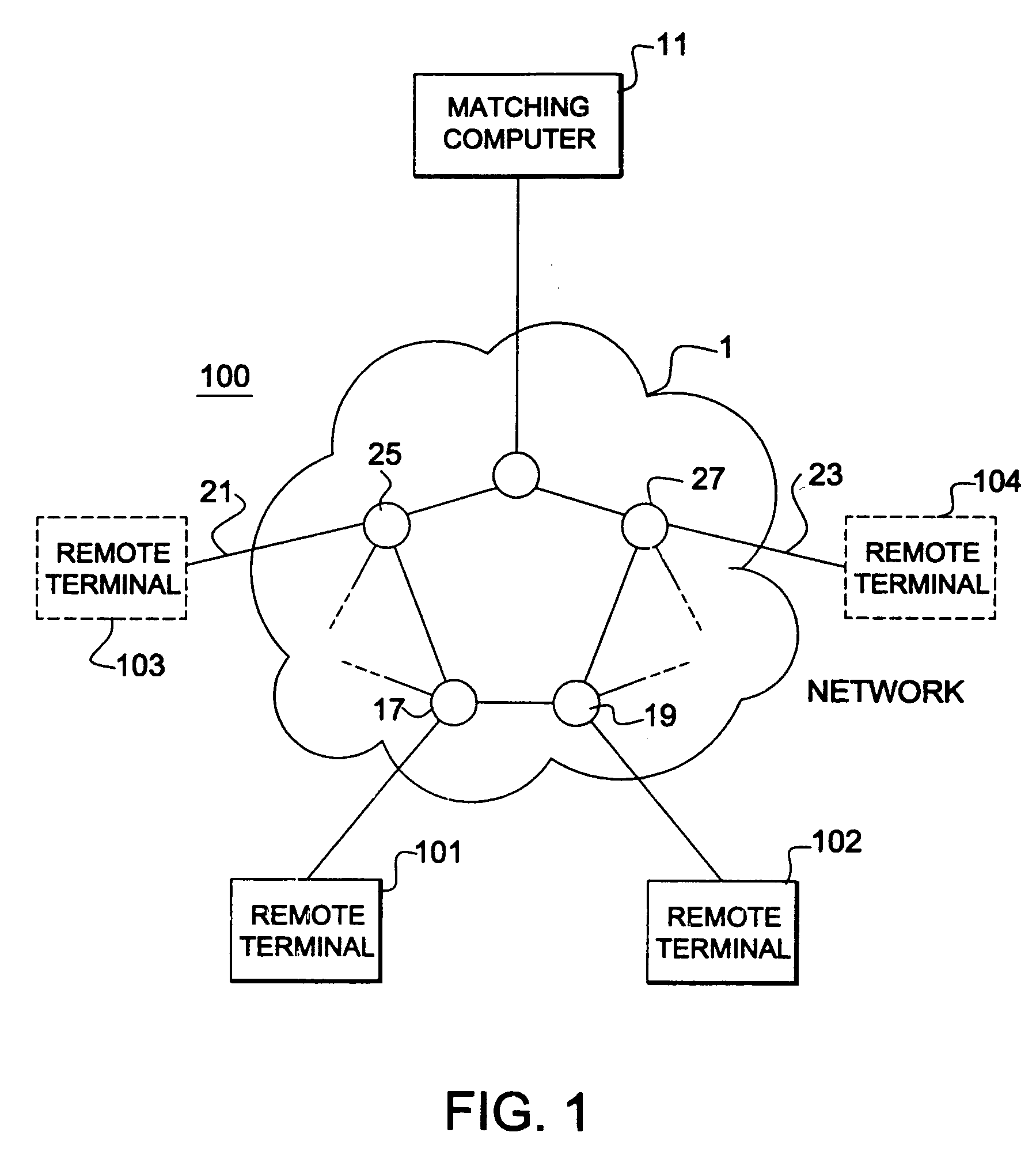

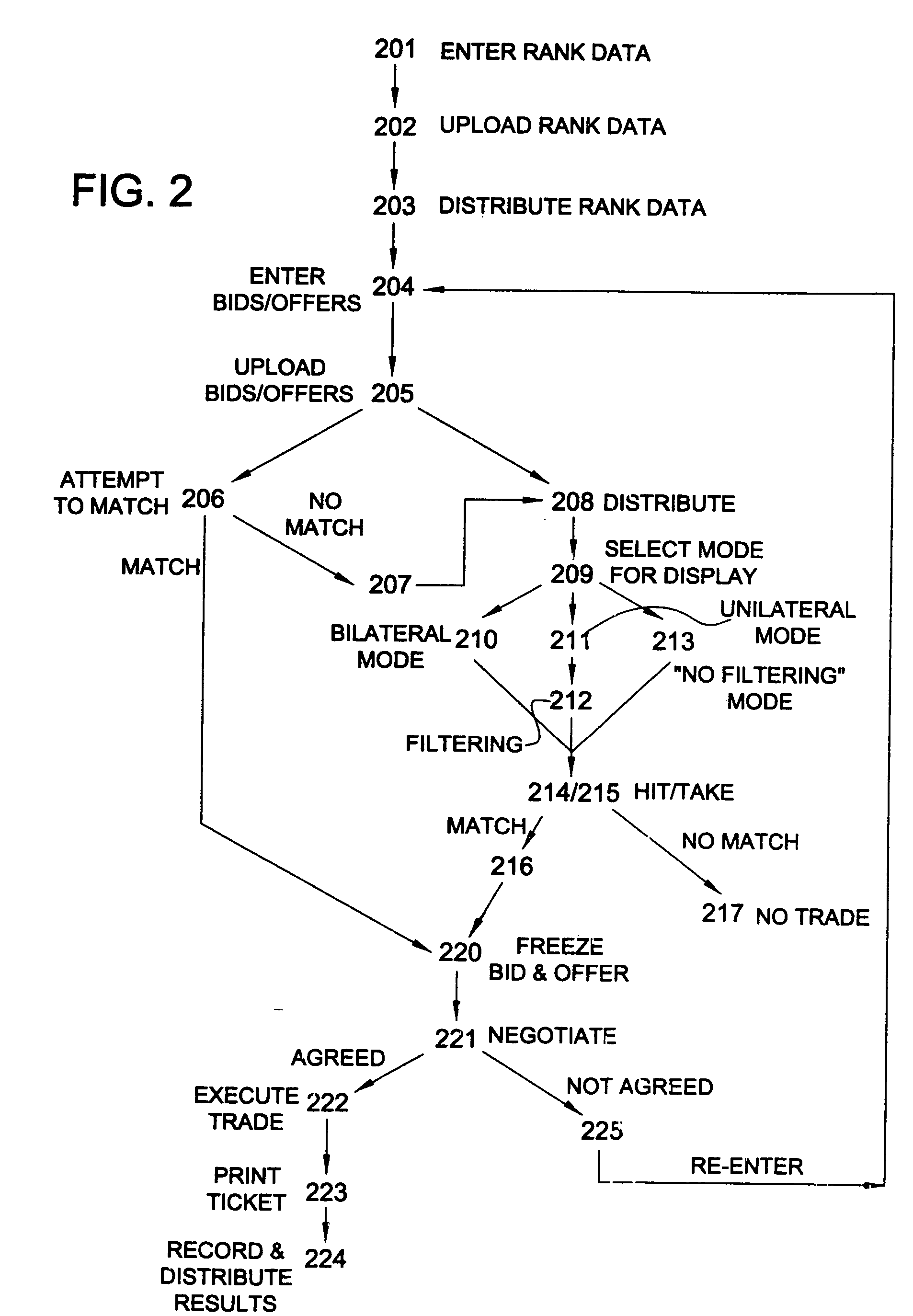

Matching computer of a negotiated matching system

A matching computer is provided for a negotiated matching system that includes a plurality of remote terminals associated with respective potential counterparties, a communications network for permitting communication between the remote terminals, and the matching computer. Each user enters first parameters for a trading instrument into his or her remote terminal. The matching computer uses the trading parameters from each user to identify potential transactions between counterparties that are mutually acceptable based on the first parameters, thereby matching potential counterparties to a potential transaction. Once a match occurs, the potential counterparties can transmit negotiating messages to negotiate some or all terms of the transaction. Thus, the matching computer first matches potential counterparties who are acceptable to each other based on first trading parameters, and then enables the counterparties to negotiate and finalize the terms of a transaction.

Owner:REUTERS LTD (GB)

Credit management for electronic brokerage system

InactiveUS20050228748A1Maintaining anonymitySpecial service provision for substationFinanceConfidentialityData mining

An anonymous trading system (FIG. 1) identifies the best bids and offers (QuoteSubmit, FIG. 3) from those counterparties (WS A1a1) with which each party (WS A1b1, WS A1b2, . . . . WSA2a2) is currently eligible to deal, while maintaining the anonymity of the potential counterparty and the confidentiality of any specific credit limitations imposed by the anonymous potential counterparty. To that end, each bid or offer (QuoteSubmit, FIG. 3) for a particular type of financial instrument is prescreened by the system for compatibility with limited credit information (for example, a one bit flag indicating whether a predetermined limit has already been exceeded) and an anonymous “Dealable” price (24,26) is calculated for each of the traders (WS A1b, . . . WS A2a) dealing with that particular financial instrument.

Owner:EBS DEALING RESOURCES

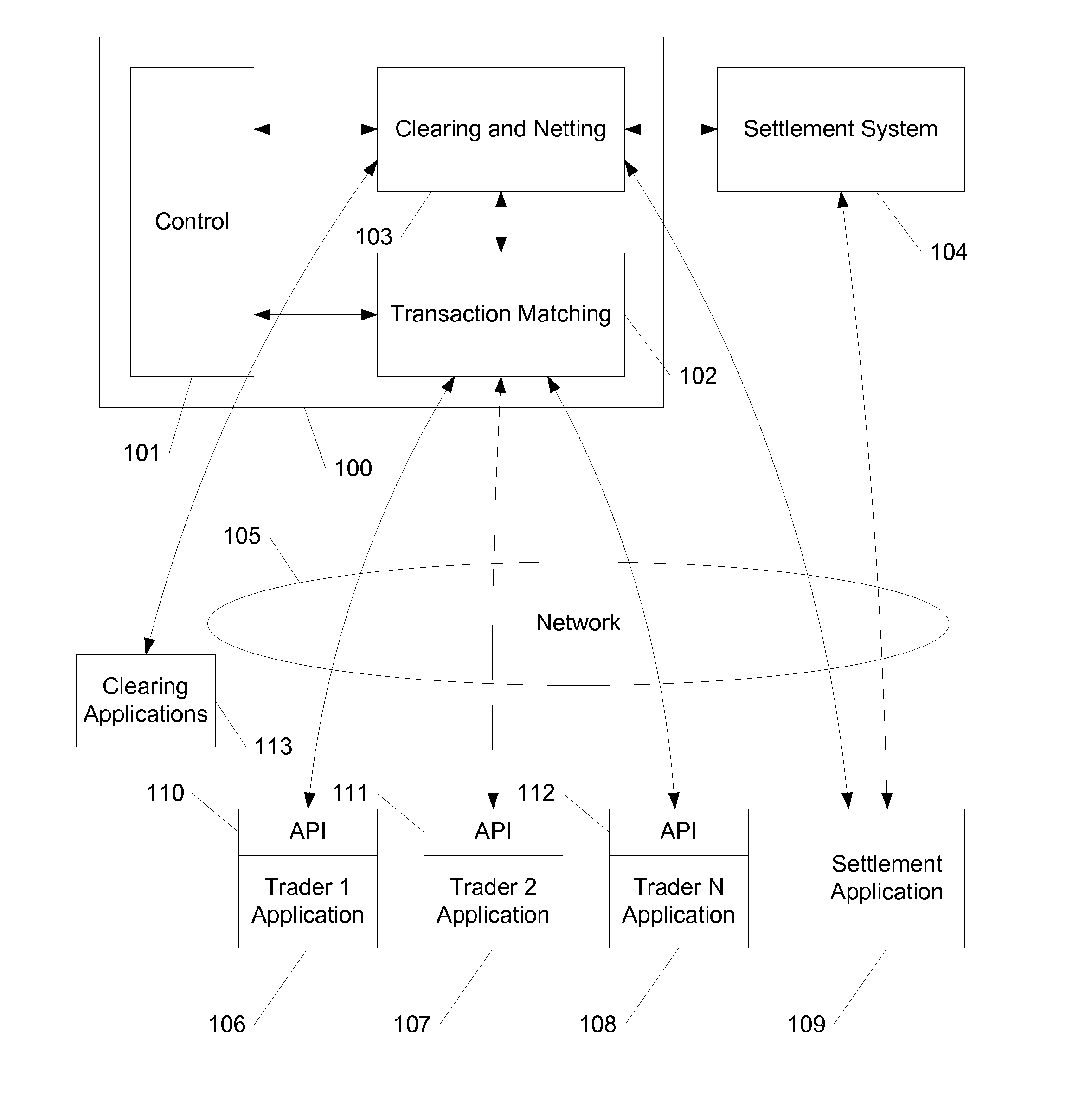

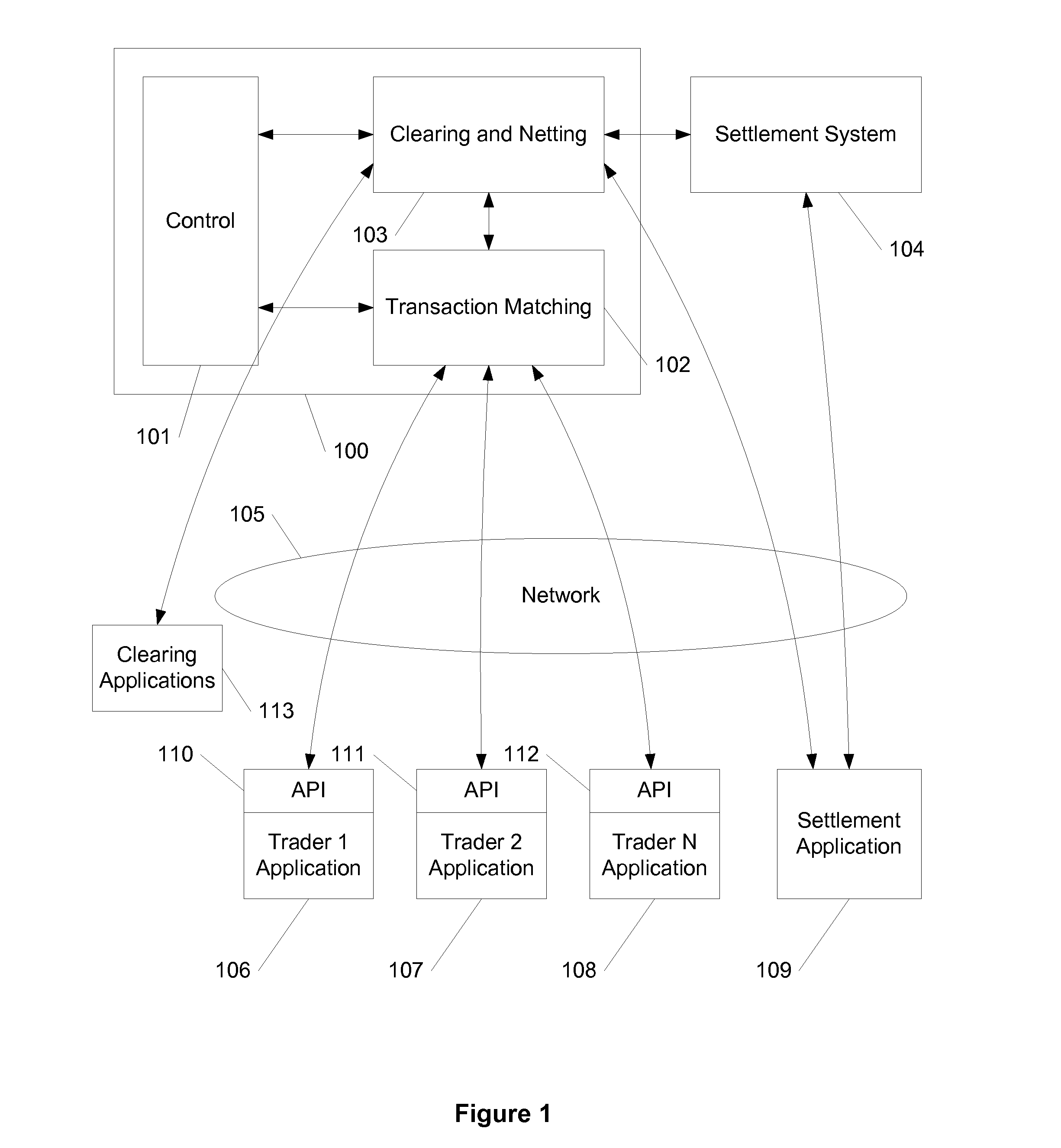

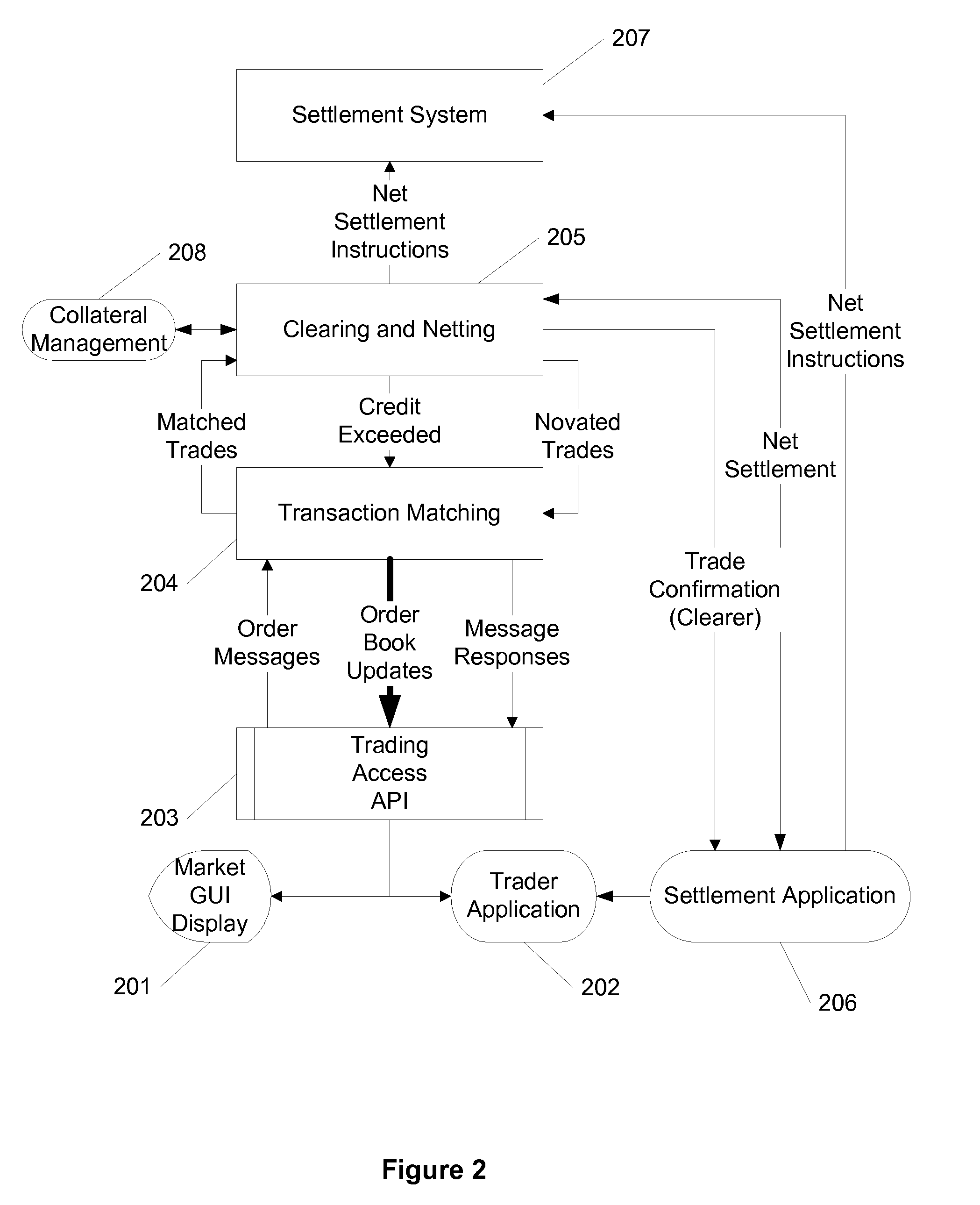

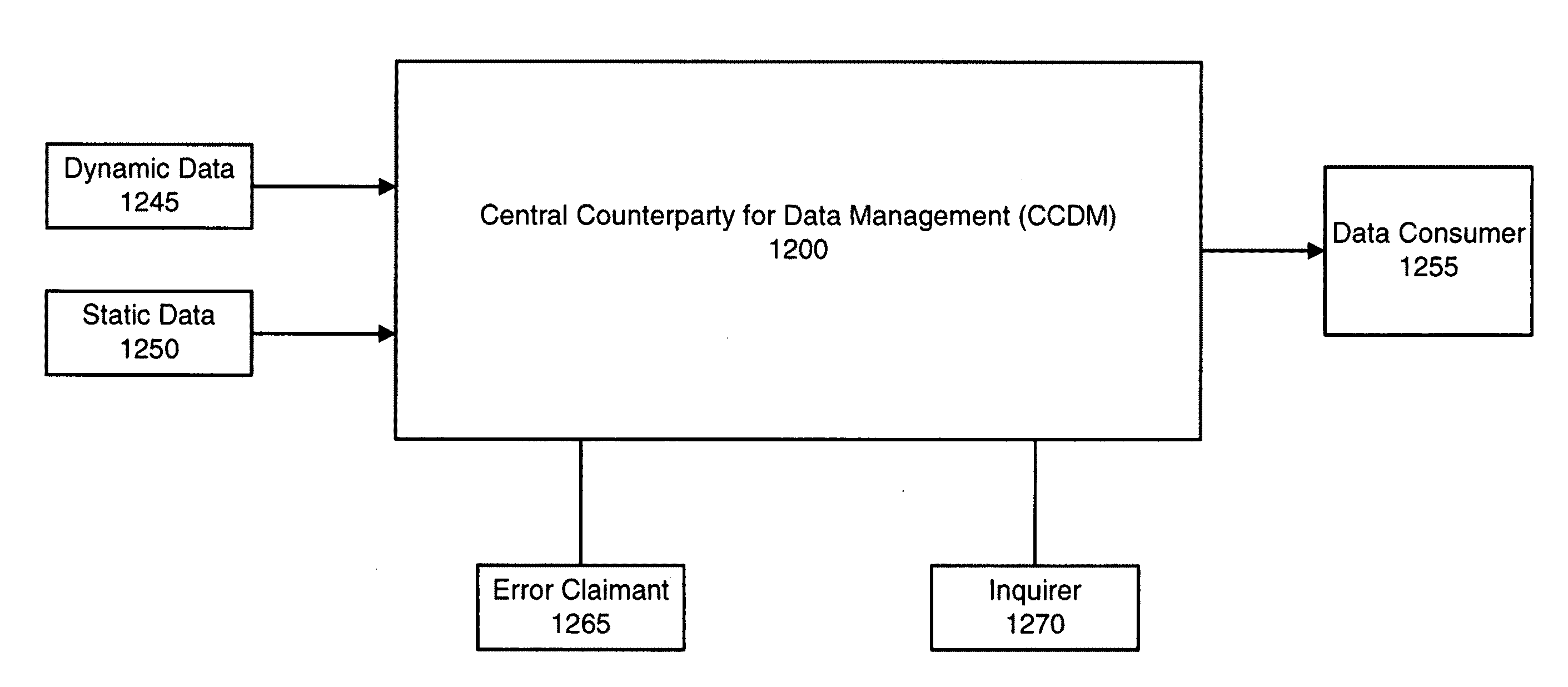

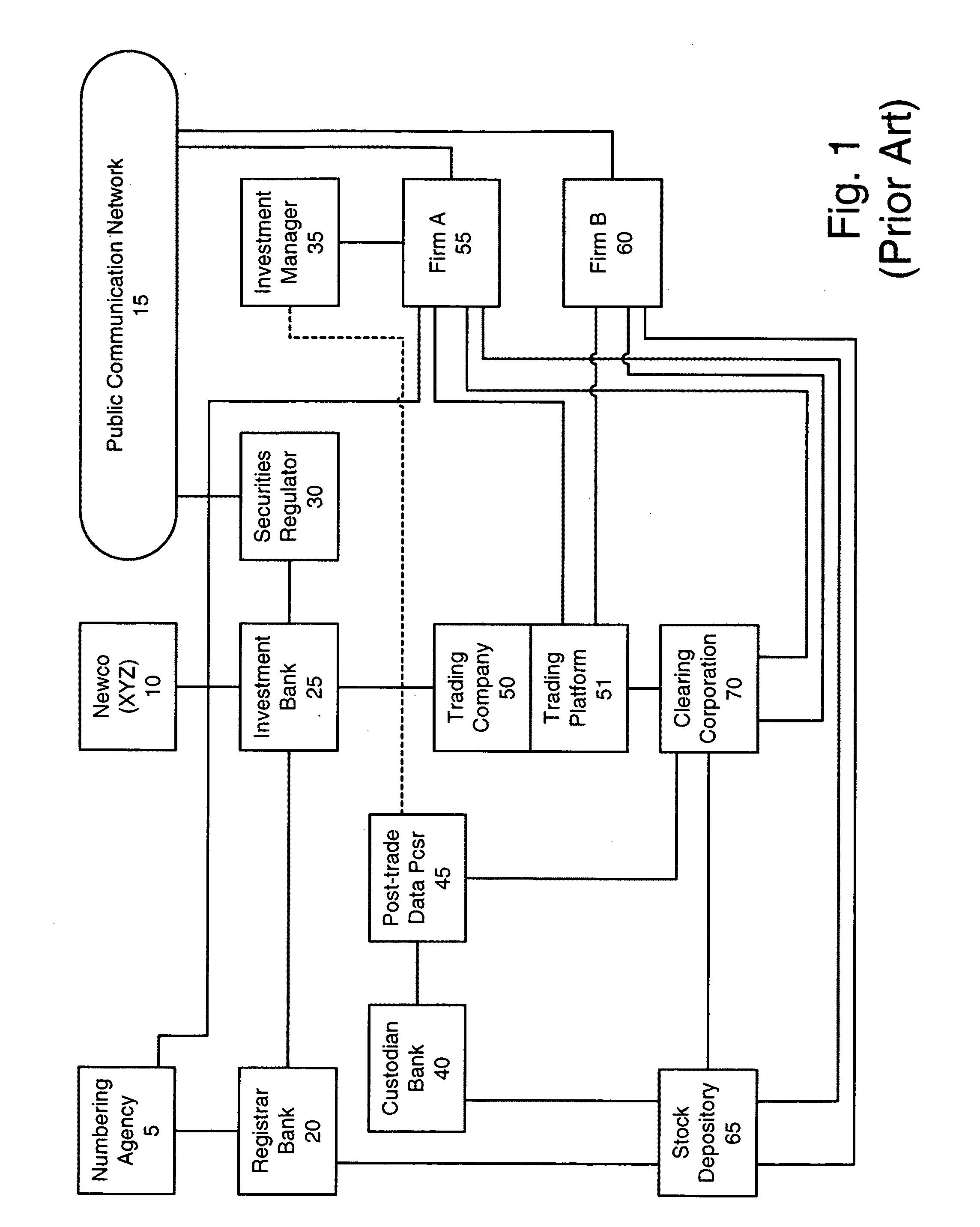

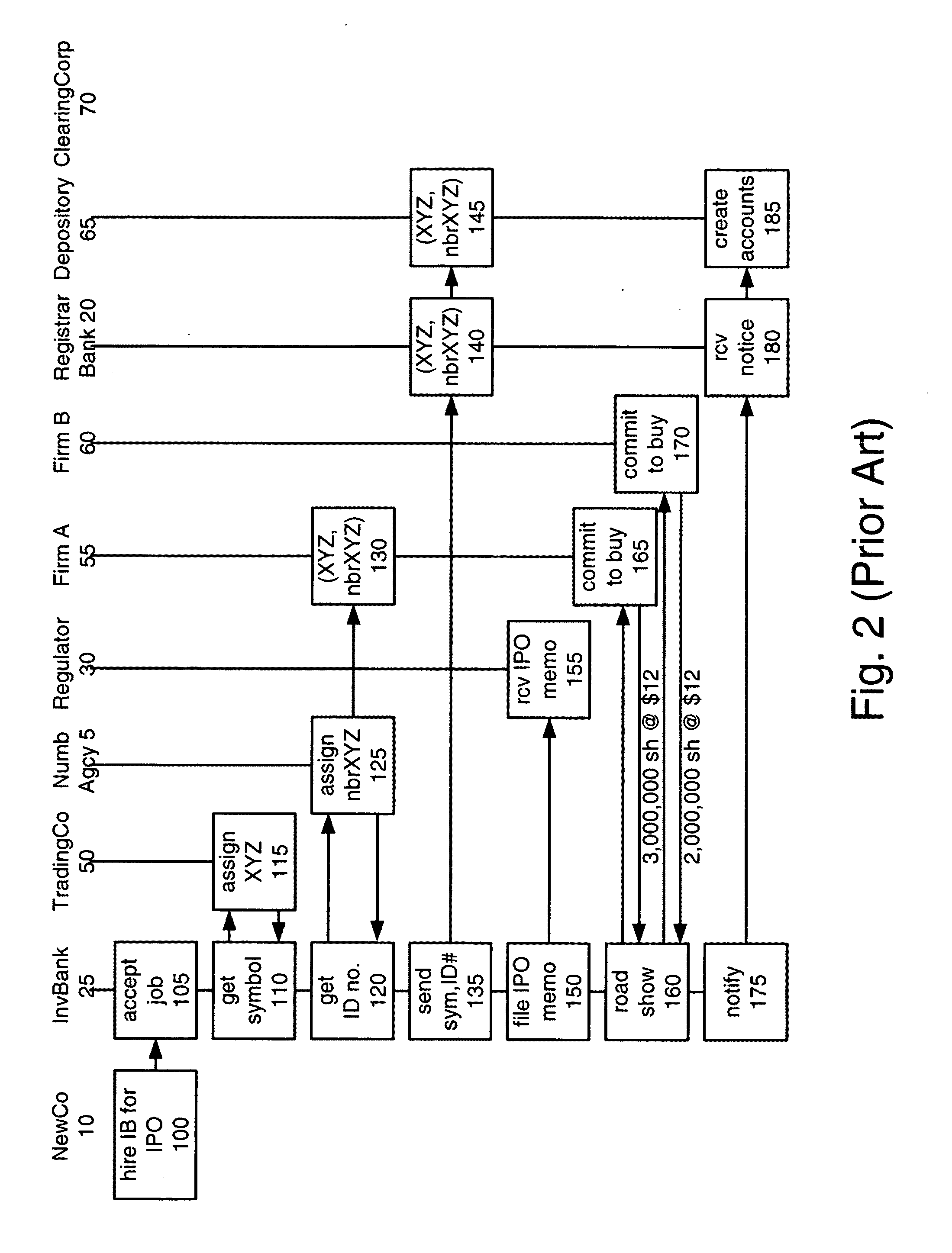

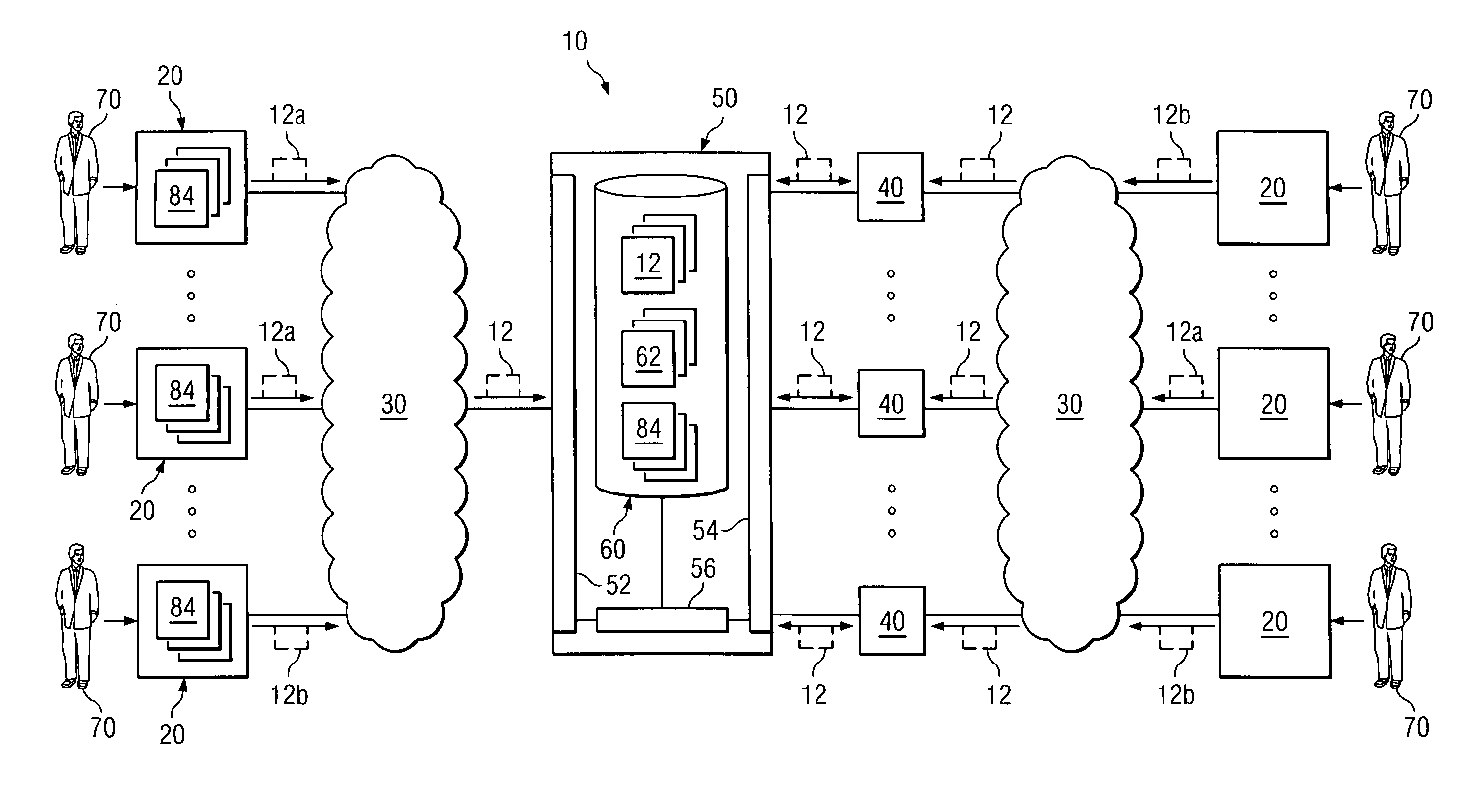

Central counterparty for data management

A central counterparty for data management (CCDM) receives data relating to financial transactions, associates the data with metadata to create reference data, stores the reference data and provides the reference data in “push” and “pull” ways. The “push” techniques for providing the data include distributing on a data feed, sending the data to parties known to be relevant to the transaction, and sending the data to parties who have a standing query that is satisfied by the data. The “pull” techniques for providing the data include responding to queries received from a variety of parties. The CCDM generates and distributes unique, unambiguous and universal identifiers (U3id's) and associates the U3id identifiers with the reference data.

Owner:FINANCIAL INTERGROUP HLDG

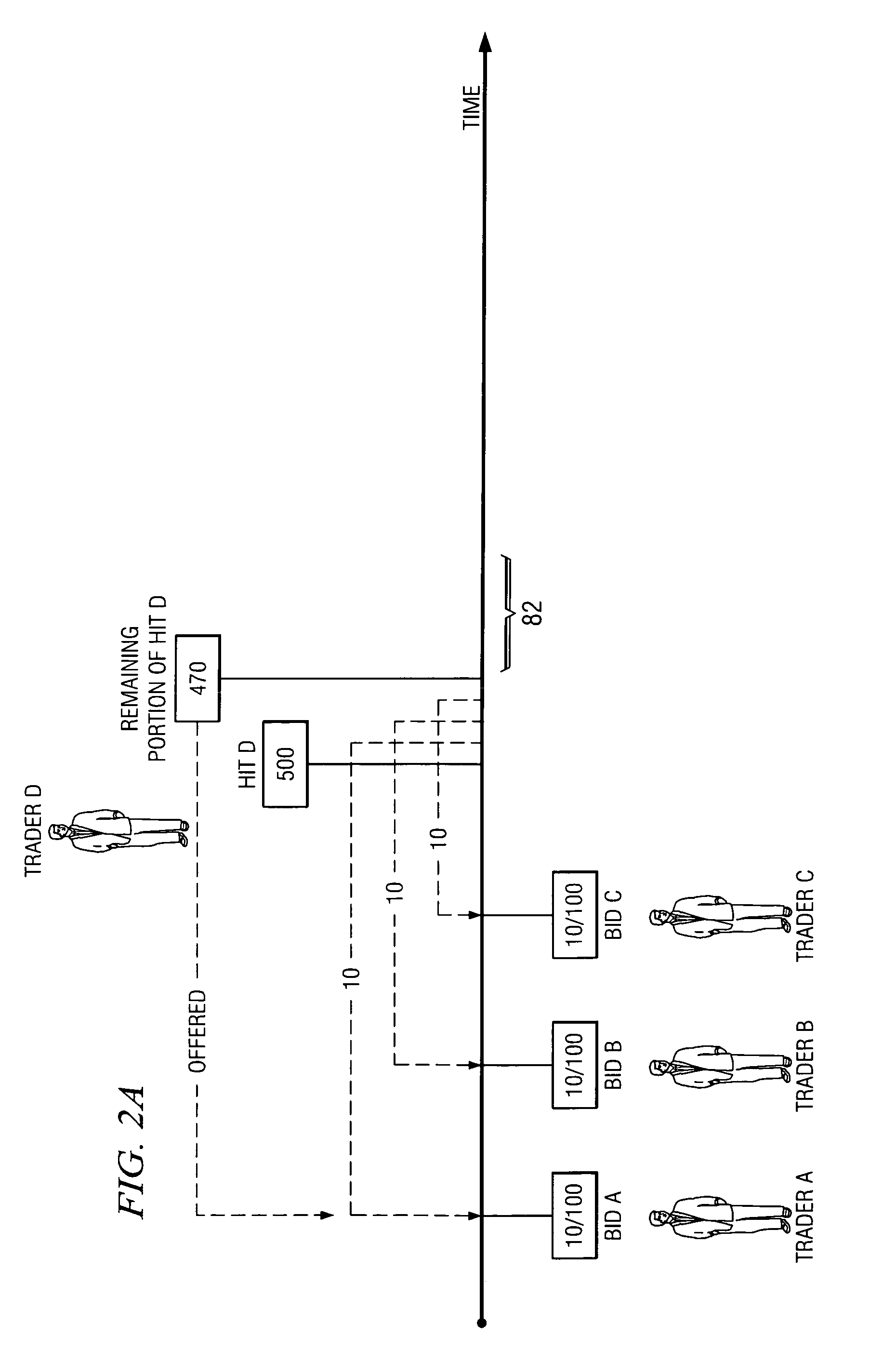

System and method for matching trading orders based on priority

ActiveUS20070130050A1Disadvantages and reduced eliminatedProblems reduced eliminatedFinanceOrder formEngineering

A system for managing trading orders comprises a memory operable to store a first trading order for a particular trading product, wherein the first trading order comprises a display portion and a reserve portion and is received from a first trader. The memory is further operable to store a second trading order for the particular trading product, wherein the second trading order comprises a display portion and a reserve portion and the second trading order is received from a second trader after the first trading order. The system further comprises a processor communicatively coupled to the memory and operable to receive from a counterparty trader a counterorder for the trading product. The processor is further operable to use the counterorder to fill the display portion of the first trading order. The processor is further operable to use the counterorder to fill the display portion of the second trading order. After filling the display portion of the second trading order, the processor is further operable to exclusively offer at least a portion of the counterorder to the first trader for a configurable period of time.

Owner:BGC PARTNERS LP

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com