Automated fixed income trading

a fixed income and automatic trading technology, applied in the field of automatic fixed income trading, can solve the problems of limited automatic execution of fixed income transactions, limited customer time, and many trading systems to be limited to a particular type, and achieve the effect of facilitating fixed income security trading activities

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

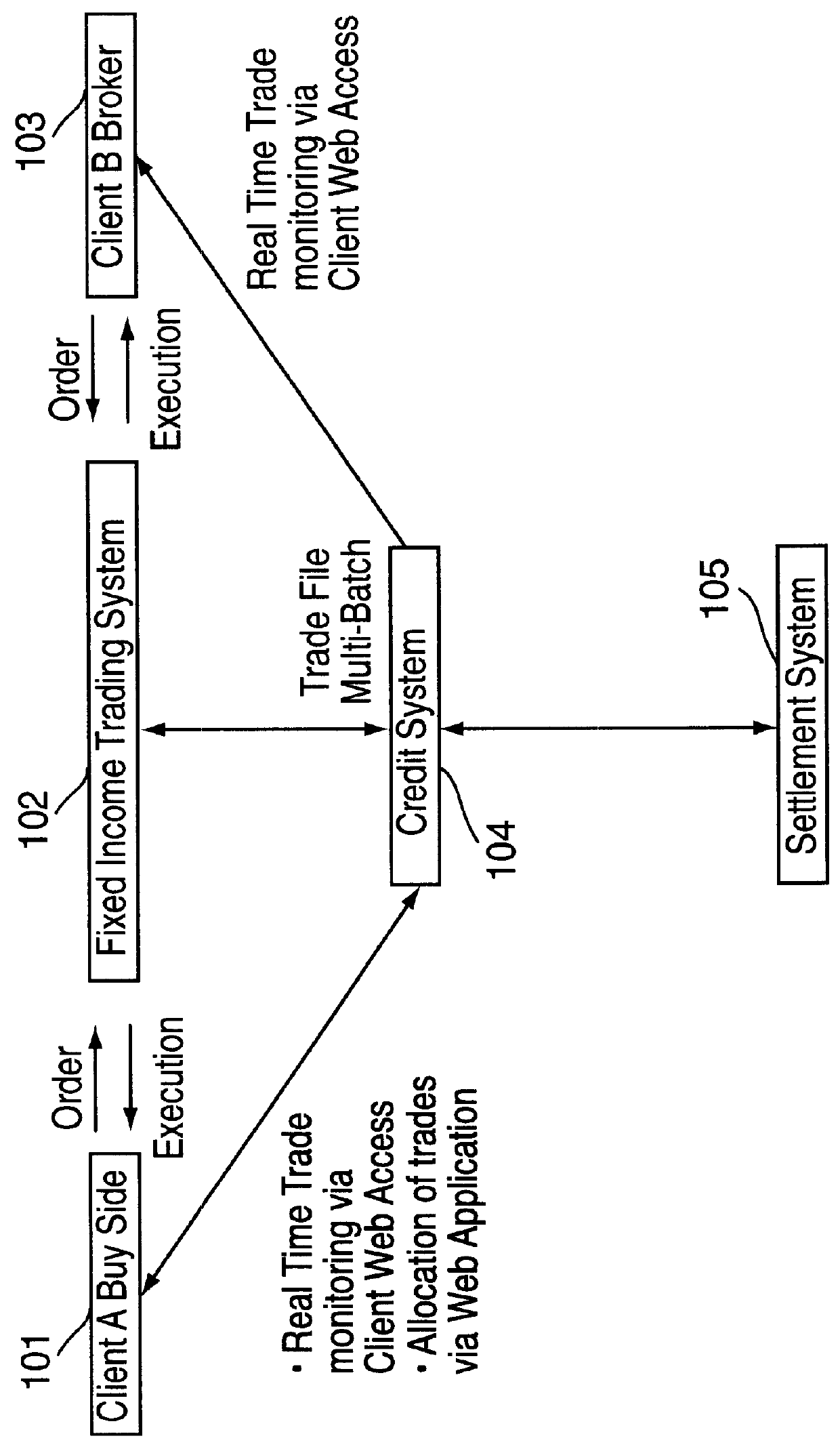

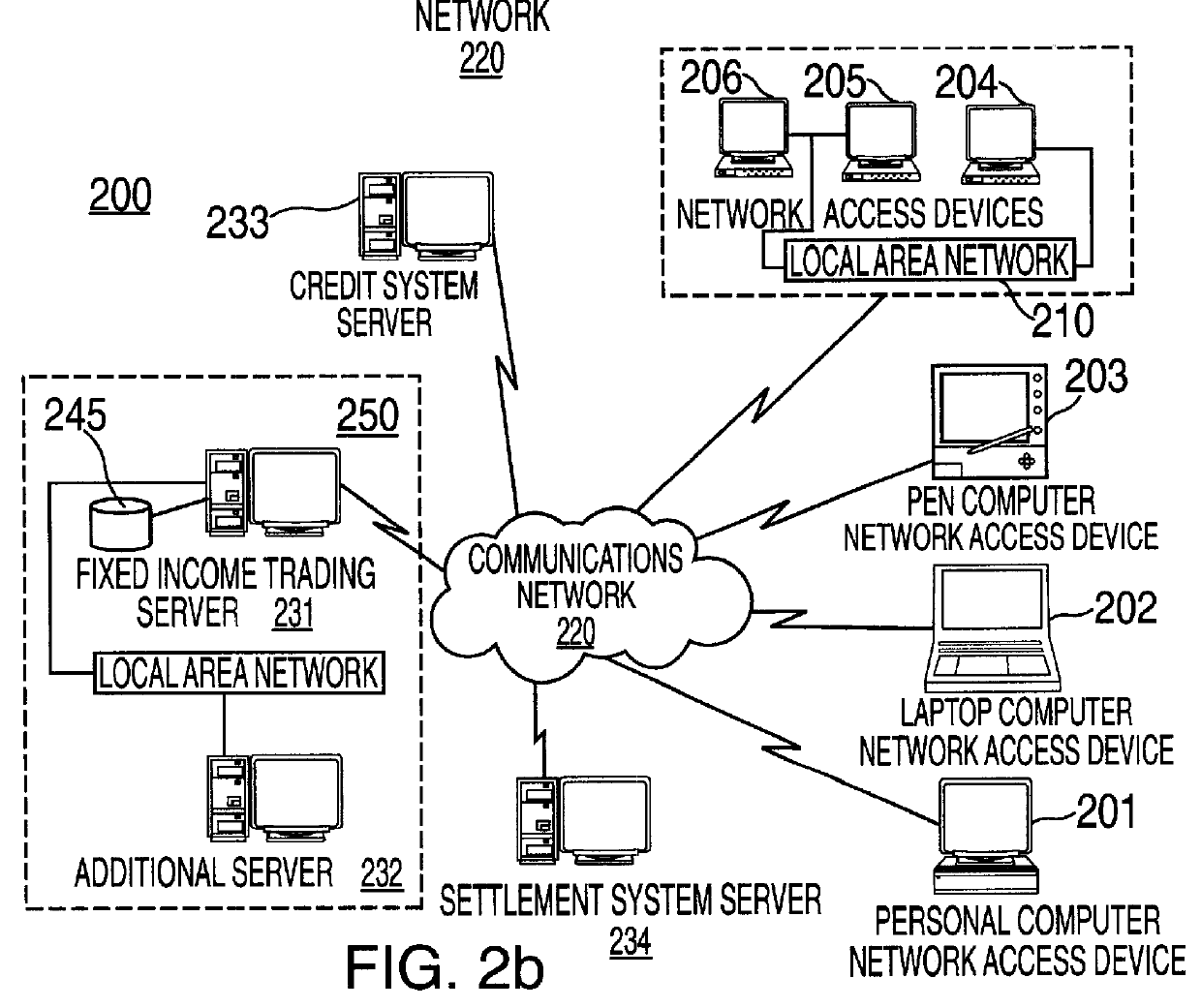

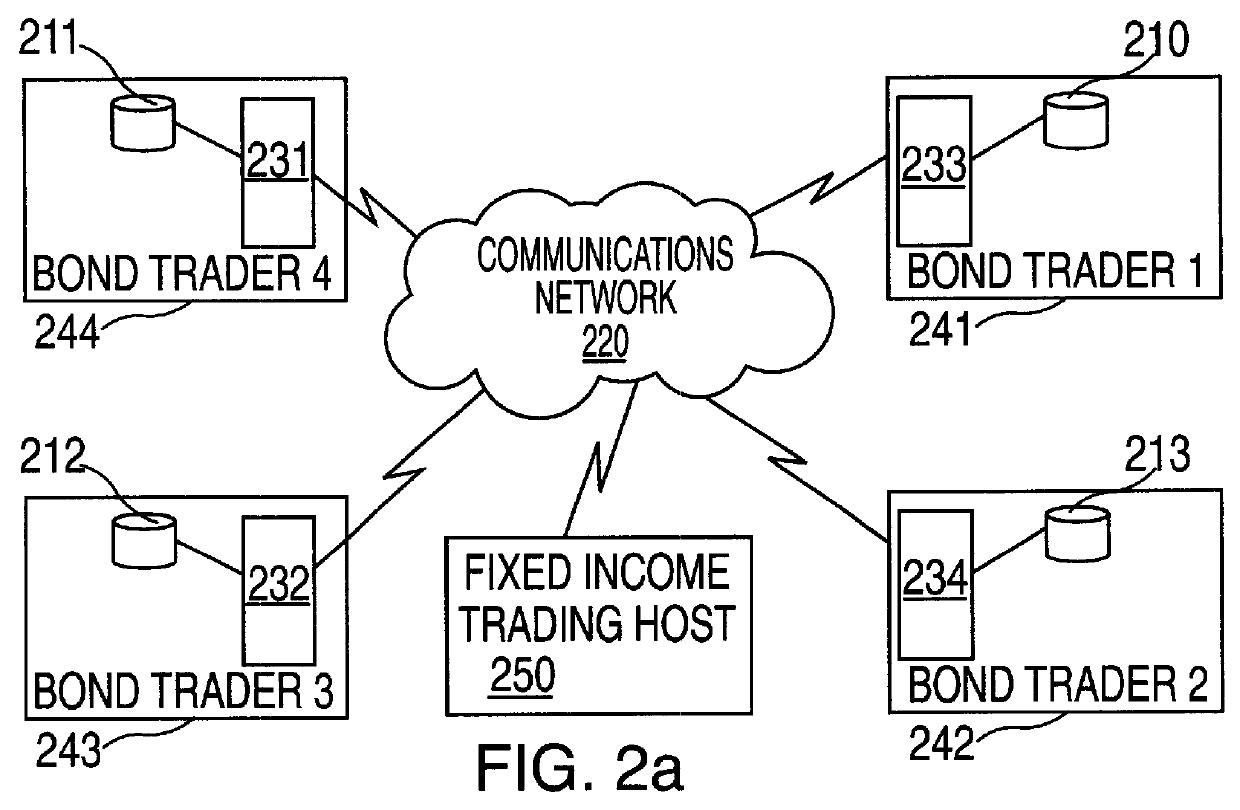

The present invention provides a method and system that enables direct trading between market participants. Market participants such as institutional investors, broker dealers and others can transact directly for the purpose of trading investment grade, high yield corporate bonds, municipal bonds or other fixed income securities. A financial institution providing a bond trading system (FIT System) can act as a counterparty to all transactions, from trade execution through settlement, and has the option to serve as a credit intermediary. The market participants are able to maintain anonymity with regard to each other. The system provides price transparency and a commitment to liquidity. Computer systems are utilized in conjunction with an electronic communications network to facilitate live execution of matched bids and offers. Software routines can direct a trader to various fixed income securities available according to specific criteria put forth by the trader.

A computer communica...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com