Multilevel relation management method and platform for credit money allocation

A credit and relationship technology, applied in the fields of finance, Internet, and big data, can solve the problems of limited credit amount, malicious fraudulent loans, low entry threshold, etc., to meet interests and needs, improve risk control capabilities, and improve distribution capabilities. Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0055] The principles and features of the present invention are described below in conjunction with the accompanying drawings, and the examples given are only used to explain the present invention, and are not intended to limit the scope of the present invention.

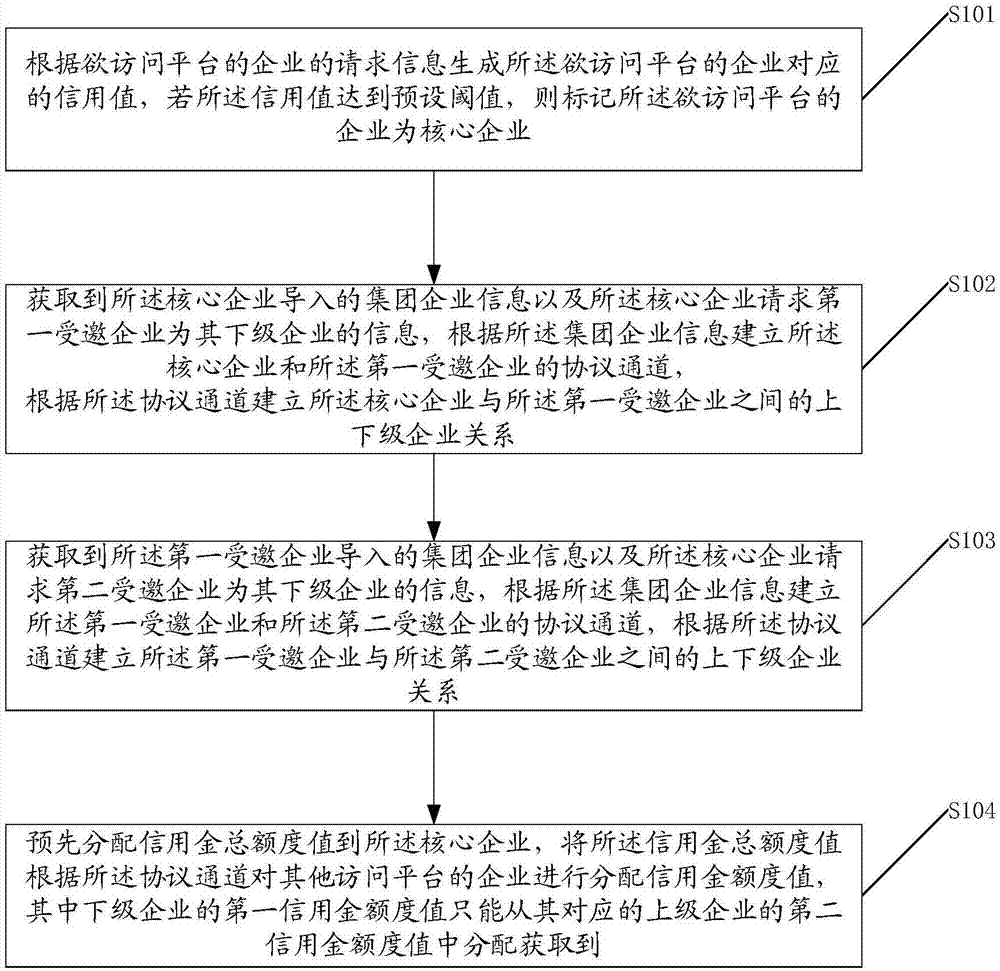

[0056] like figure 1 A method for managing the multi-level relationship of credit allocation provided by Embodiment 1 of the present invention is given, the method includes:

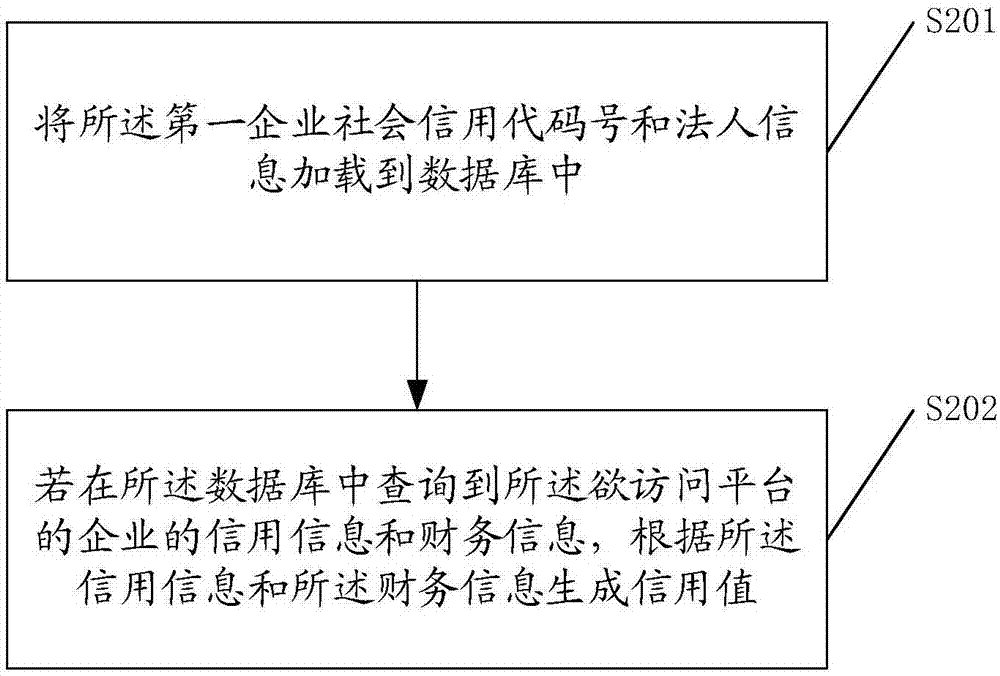

[0057] S101. Generate a credit value corresponding to the company that wants to access the platform according to the request information of the company that wants to access the platform. If the credit value reaches a preset threshold, mark the company that wants to access the platform as a core company;

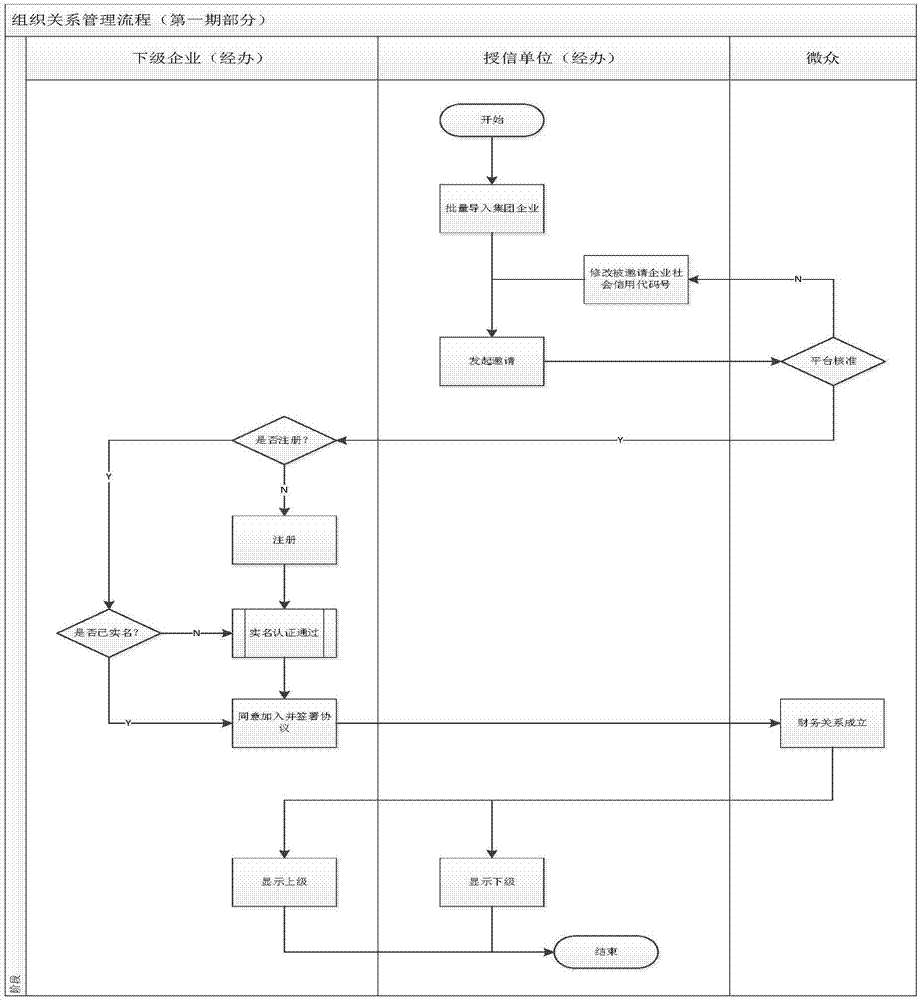

[0058] S102. Obtain the group enterprise information imported by the core enterprise and the information that the core enterprise requests the first invited enterprise to be its subordinate enterprise, and establish the core enterprise and th...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com