Patents

Literature

72results about How to "Improve risk control ability" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

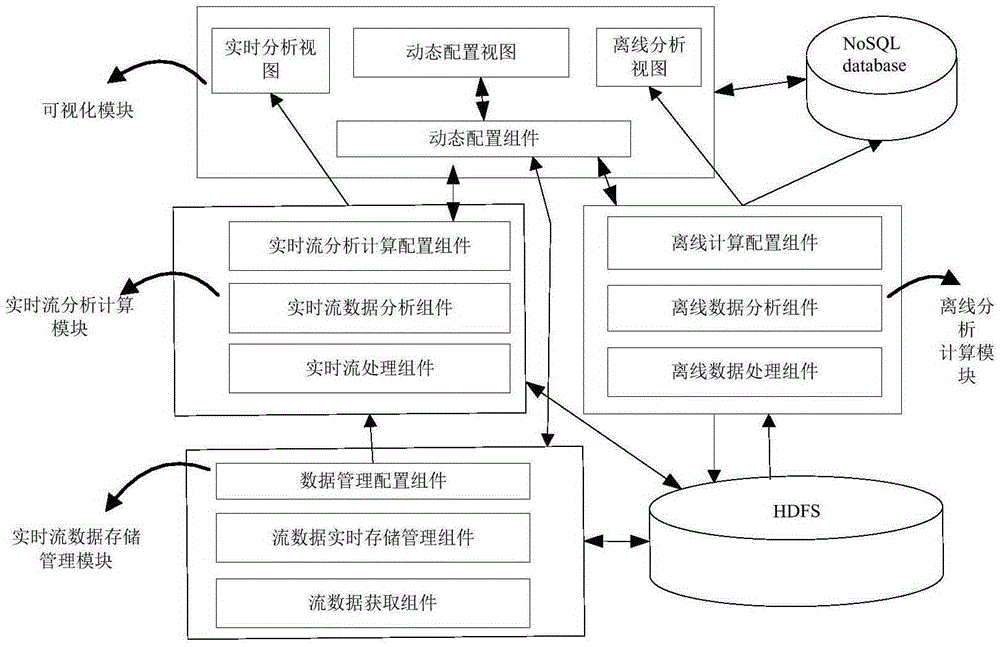

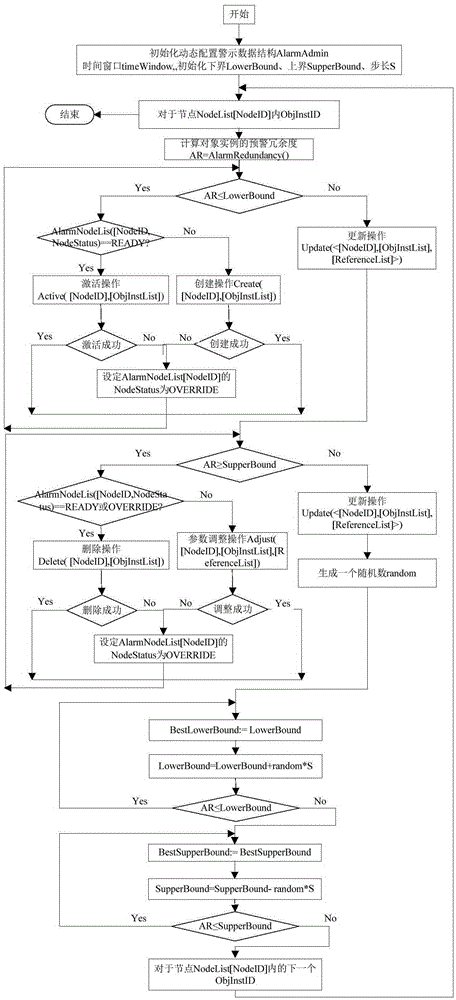

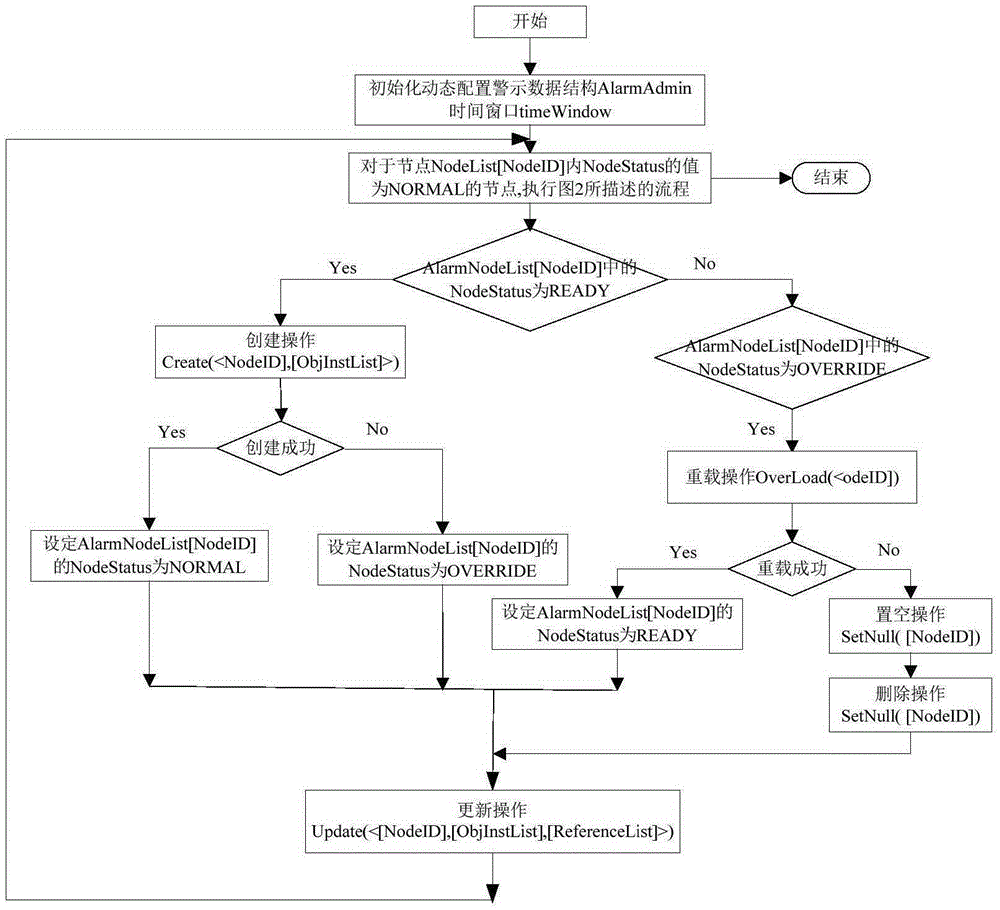

Dynamically configured big data analysis system and method

ActiveCN105279603ARealize configuration optimizationImprove reliabilityResourcesSpecial data processing applicationsData analysis systemTime data

The invention discloses a dynamically configured big data analysis system and method. The system includes a real-time data storage management module, a real-time flow analysis and calculating module, an off-line analysis module, and a visualization module. At least one assembly capable of performing dynamical configuration management is arranged in each module, for example, a data management configuration assembly, a real-time flow analysis and calculating configuration assembly, an off-line analysis and calculating configuration assembly, and a dynamic configuration assembly. The invention further provides a dynamical configuration method of the big data analysis system. A data structure and an information structure of each module are designed, and a calculating method of warning redundancy and a dynamic configuration method are provided through the dynamic configuration of a state information driving system of a warning data structure in a dynamic configuration manager. According to the invention, the system can run at an efficient big data analysis and calculating level, and the optimization process of big data analysis platform management is effectively solved.

Owner:FUJIAN NORMAL UNIV

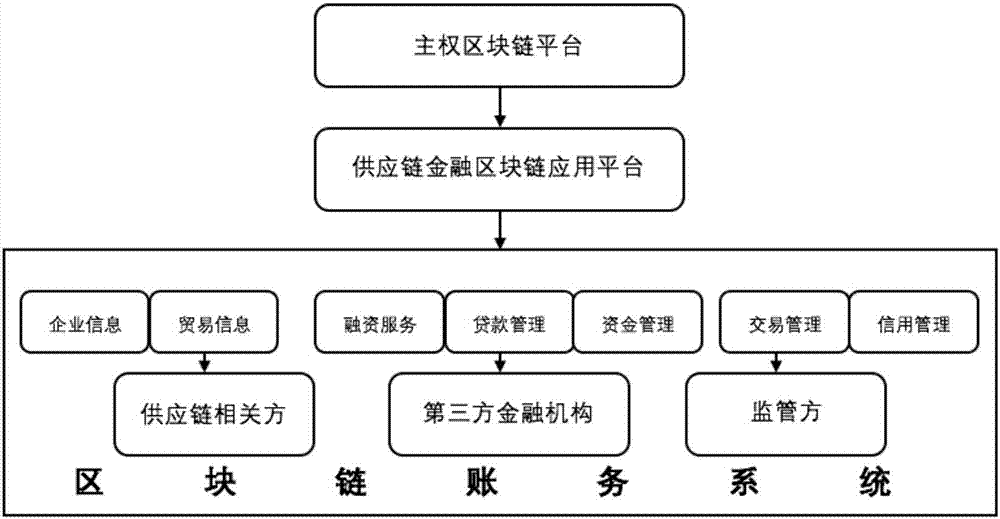

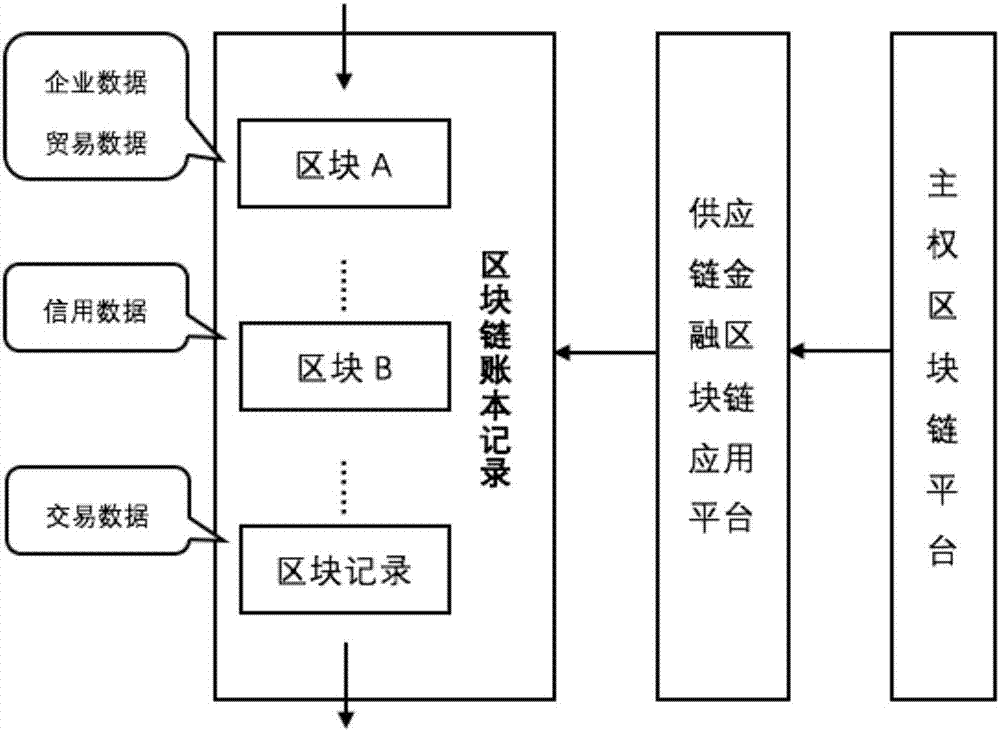

Supply chain finance block chain application method based on sovereign block chain

The invention discloses a supply chain finance block chain application method based on a sovereign block chain technology. The invention relates to a block chain field and especially relates to a sovereign block chain field. By using the method, problems that supply chain financing rate is low; a supply chain can not high-efficiently achieve a credit function; and a supply chain finance ecosphere cooperation development is restricted are solved. In the invention, based on the sovereign block chain technology, a block chain application platform suitable for China supply chain finance is constructed so that safety and traceability of supply chain finance application are increased. Mutual trust is established and transaction cost is reduced. Productivity of each node of a whole supply chain and a fund utilization rate are increased. A supervision node is provided for a supervision mechanism and whole process links of the supply chain finance are supervised.

Owner:UNIV OF ELECTRONICS SCI & TECH OF CHINA

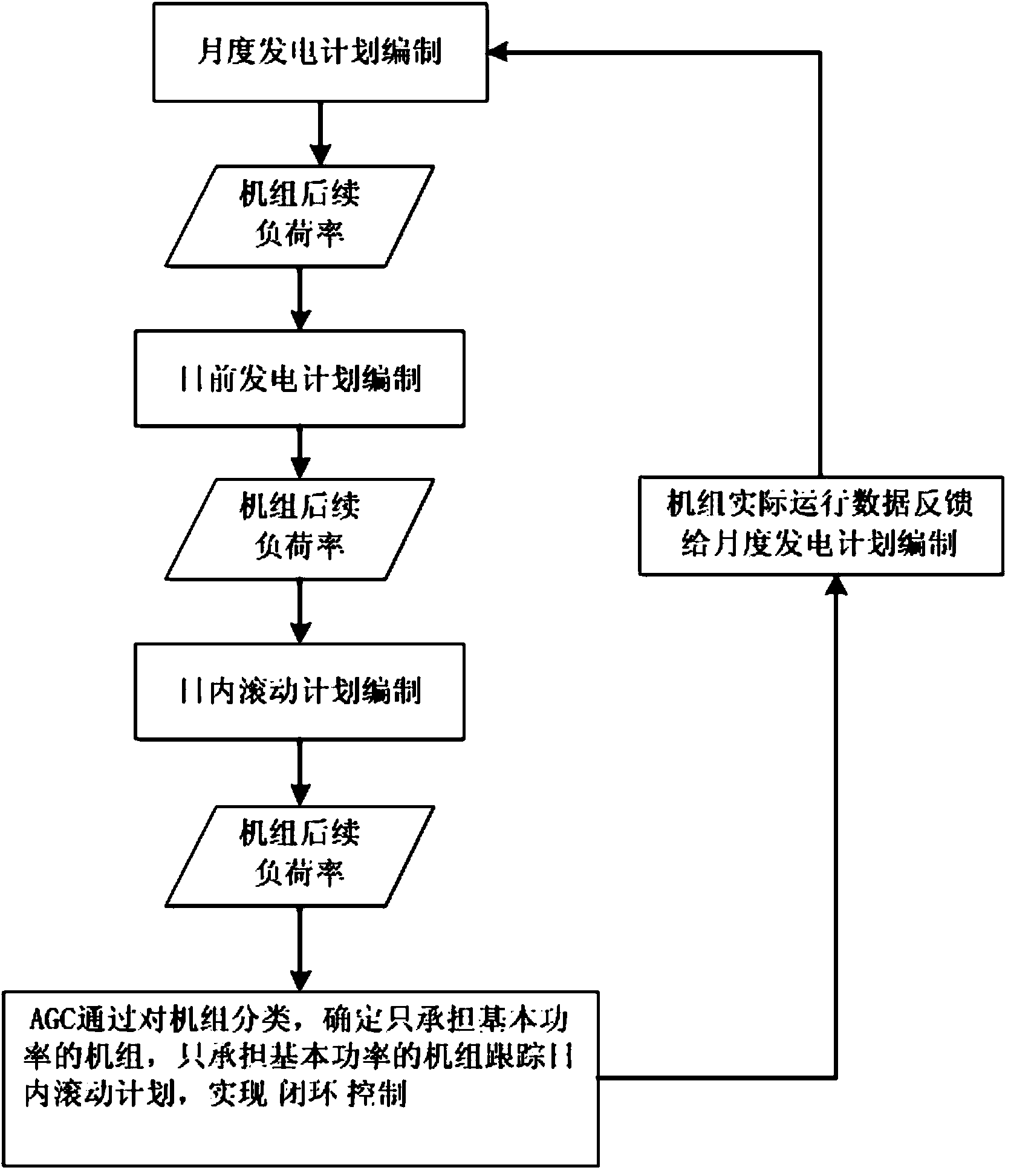

Multi-cycle generation scheduling coordinated optimization and closed-loop control method

ActiveCN103886388AIncreased safety marginRaise the level of leanForecastingSystems intergating technologiesProgram planningClosed loop

The invention discloses a multi-cycle generation scheduling coordinated optimization and closed-loop control method which comprises the following steps that first, a monthly generation schedule is made; second, a day-ahead generation schedule is made; third, an intra-day rolling schedule is made; fourth, AGC determines units which only bear basic power through unit classification, and the units which only bear basic power track the intra-day rolling schedule to achieve closed-loop control; fifth, actual operation data of the units are fed back to the monthly generation schedule, and the monthly generation schedule is corrected in a rolling mode. The multi-cycle generation scheduling coordinated optimization and closed-loop control method for the operation plan field is achieved, overall resource optimized allocation and safety constrained control on a longer time dimension are achieved, and the scheduling target for impartiality and openness plus energy conservation at the same time is achieved.

Owner:STATE GRID CORP OF CHINA +3

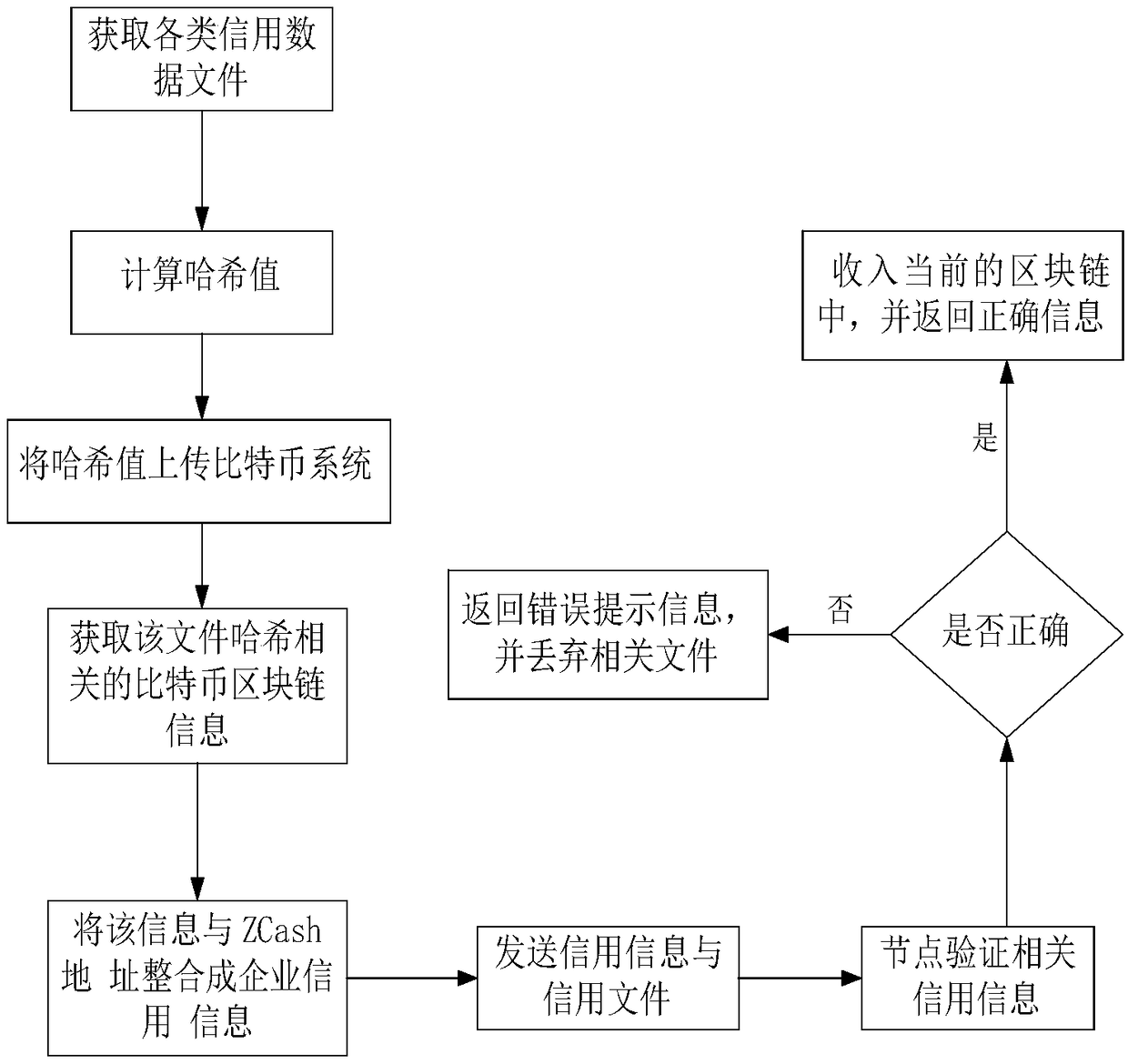

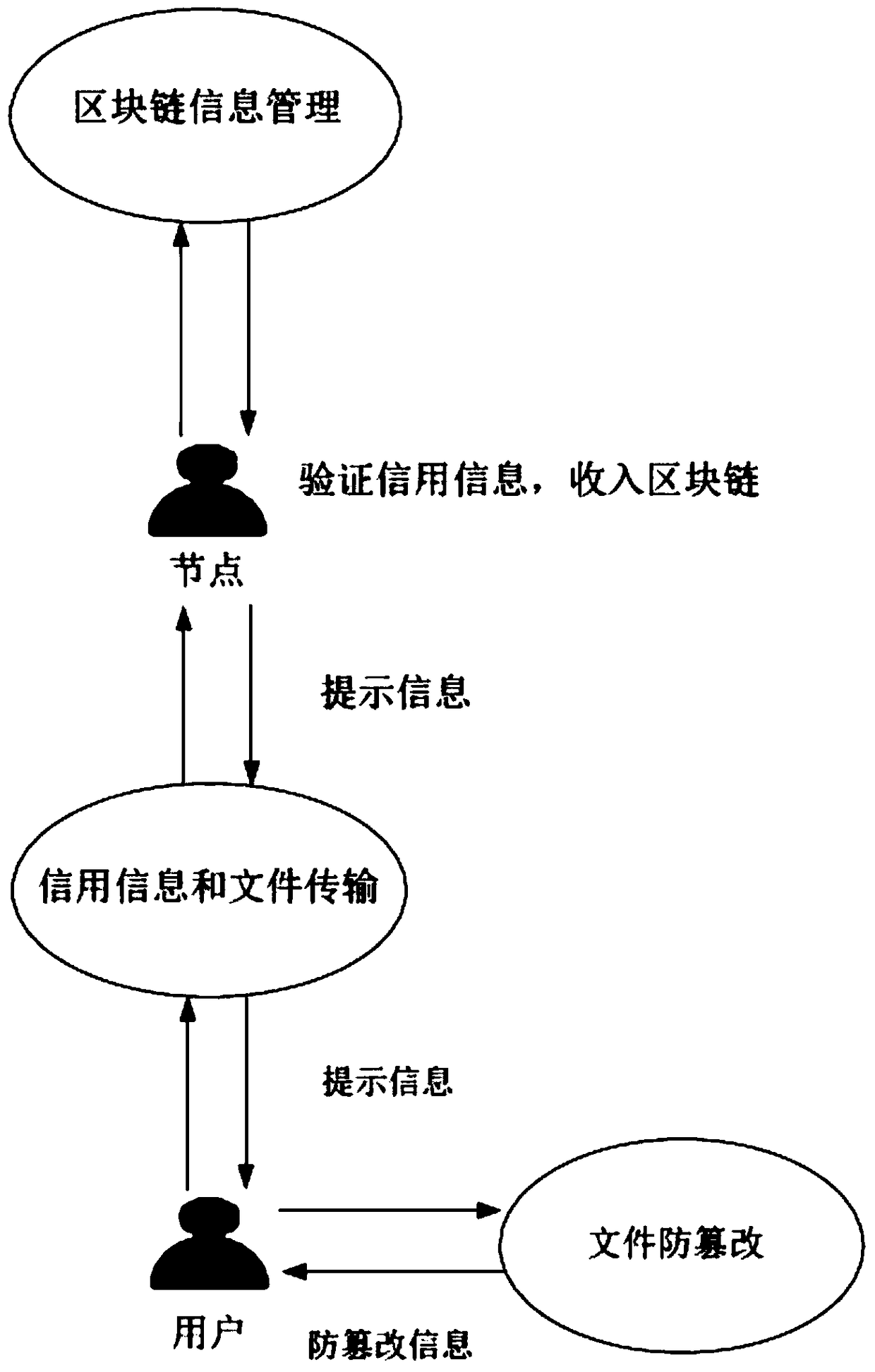

An agricultural product traceability insurance public service platform based on a block chain technology

InactiveCN109410076AReduce operating costsEasy to operateFinanceCommerceThird partyTransaction management

The invention discloses an agricultural product traceability insurance public service platform based on a block chain technology. The agricultural product traceability insurance public service platform comprises a block chain data acquisition and storage subsystem, an insurance business transaction management subsystem, a public service portal, a third-party interface service subsystem and a datastatistics subsystem, wherein the block chain data acquisition and storage subsystem collects credit data files and information related to a bitcoin block chain related to the credit data files, and the information is recorded into a block chain of the subsystem to be stored after being subjected to information verification through each information node; the insurance business transaction management subsystem is used for providing online transaction management service for an insurance company; and the public service portal is used for providing an insurance transaction result and transaction file online query. According to the invention, through the blockchain technology, all kinds of production and operation activity process data of agricultural enterprises and financial insurance services are bound, innovation of Internet insurance products is realized, agricultural product appreciation is brought to agriculture-related enterprises, and the risk of the agriculture-related enterprisesis reduced.

Owner:广州农联科创信息技术有限公司

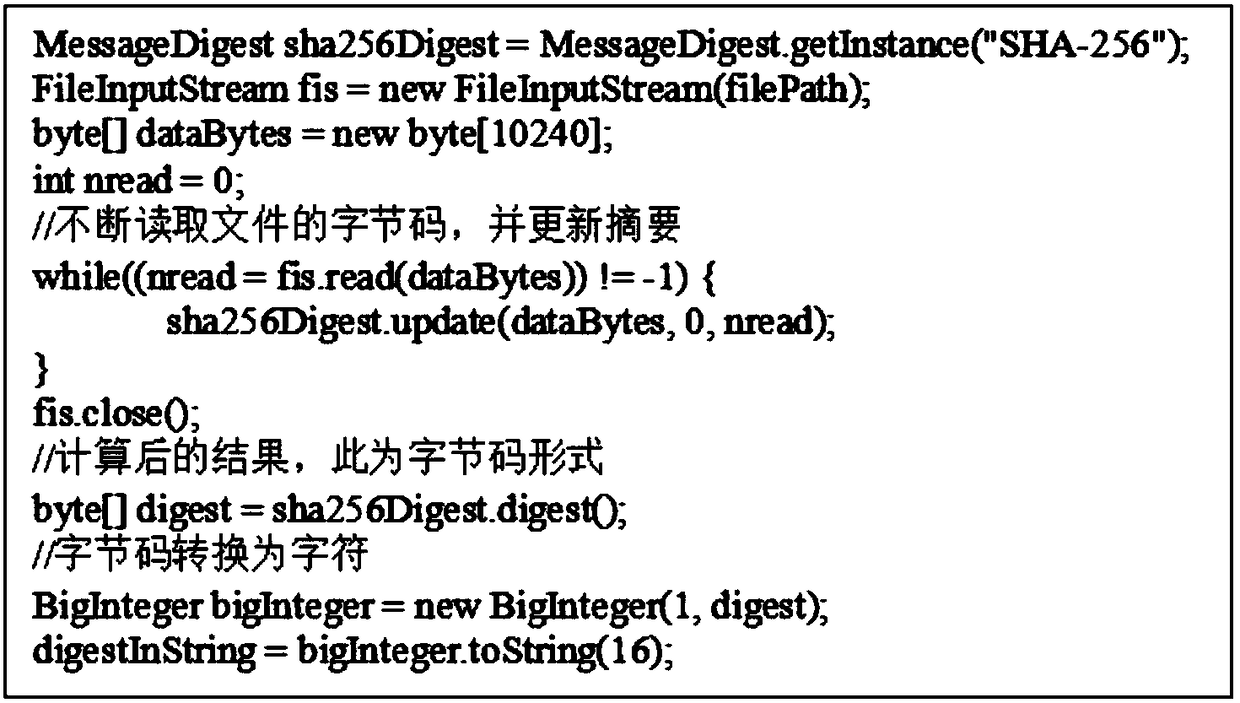

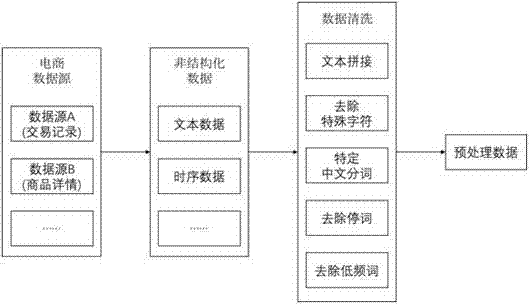

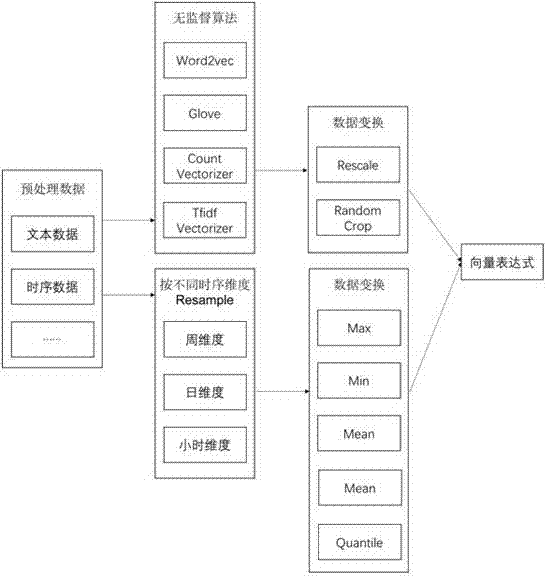

Unstructured data default probability prediction method based on deep learning

ActiveCN107992982AThe solution cannot be efficientlySolve usabilityFinanceForecastingRisk ControlUnstructured data

The invention relates to an unstructured data default probability prediction method based on deep learning. The method comprises the steps as follows: unstructured data, including text data and time series data, of credit subjects are integrated and cleaned; the unstructured data are converted into a data format recognizable by a deep learning model; data features are extracted as sample data on the basis of a deep learning model frame; as for the extracted sample data, a credit risk model is constructed by use of a complex machine learning classification algorithm-integrated tree model, and default probability prediction is output. According to the method, the unstructured data such as text and time sequence data are mined, potential risk behavior modes of the credit subjects are caught on the basis of deep learning and a big data technology, high dimensional data credit risk modeling is performed accordingly, automatic, comprehensive and procedural quantitative credit risk analysis for the credit subjects is realized, the finance risk control capacity is improved, and the credit risk is reduced.

Owner:上海氪信信息技术有限公司

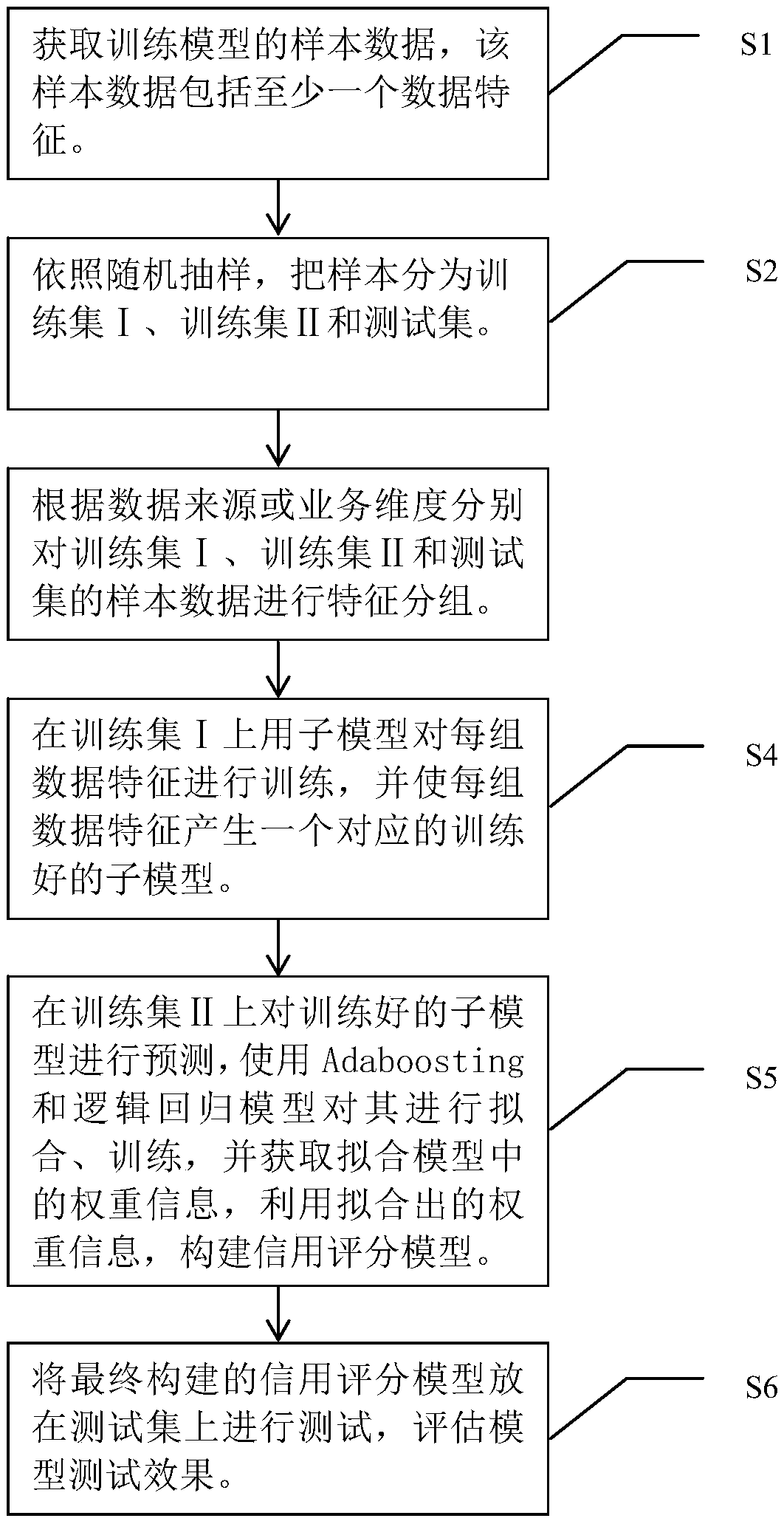

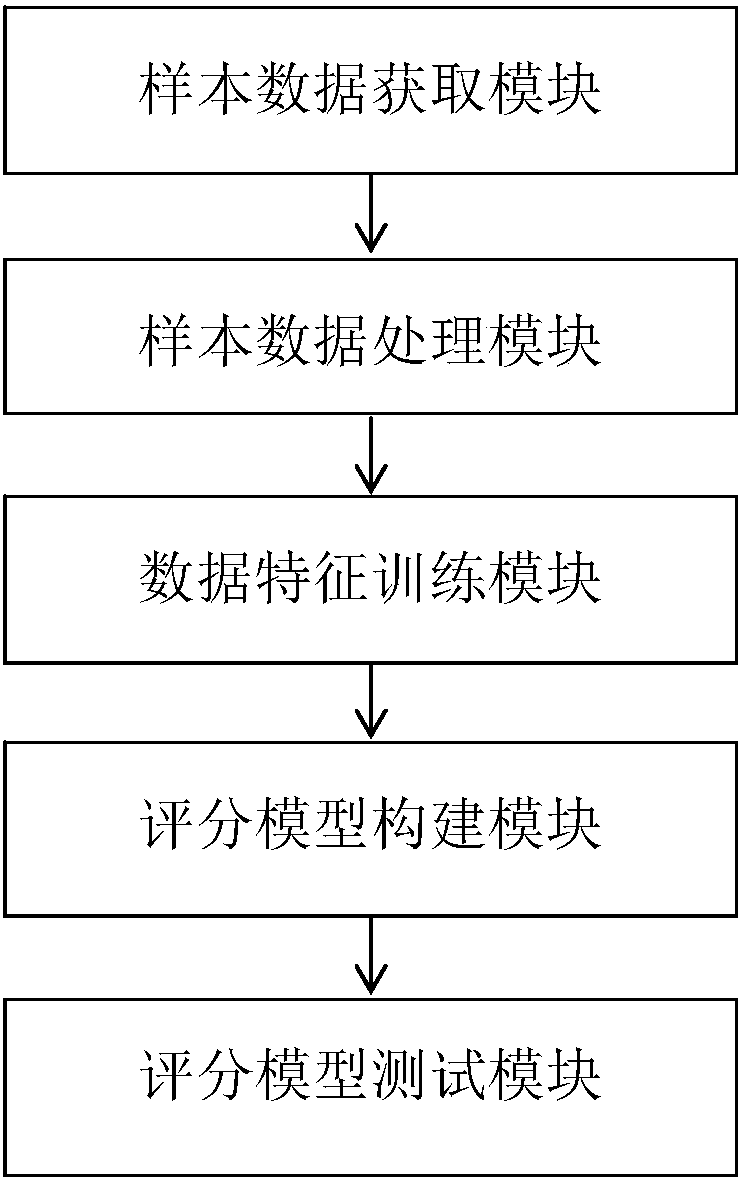

Personal-credit evaluation method of intelligent combination and system

The invention discloses a personal-credit evaluation method of intelligent combination and a system. The method is suitable for use in the system. The system includes a sample data acquisition module,a sample data processing module, a data feature training module, a scoring model construction module and a scoring model test module. The method includes the steps of: S1, acquiring sample data of model training by the sample data acquisition module; S2, dividing samples into a training set I, a training set II and a test set; S3, carrying out feature grouping on the sample data of the training set I, the training set II and the test set; S4, carrying out training on each set of data features, and generating a corresponding trained sub-model by each set of data features; S5, carrying out prediction on the trained sub-models; and S6, testing a finally constructed credit scoring model on the test set by the scoring model test module to evaluate model test effect.

Owner:大连普惠火眼科技有限公司

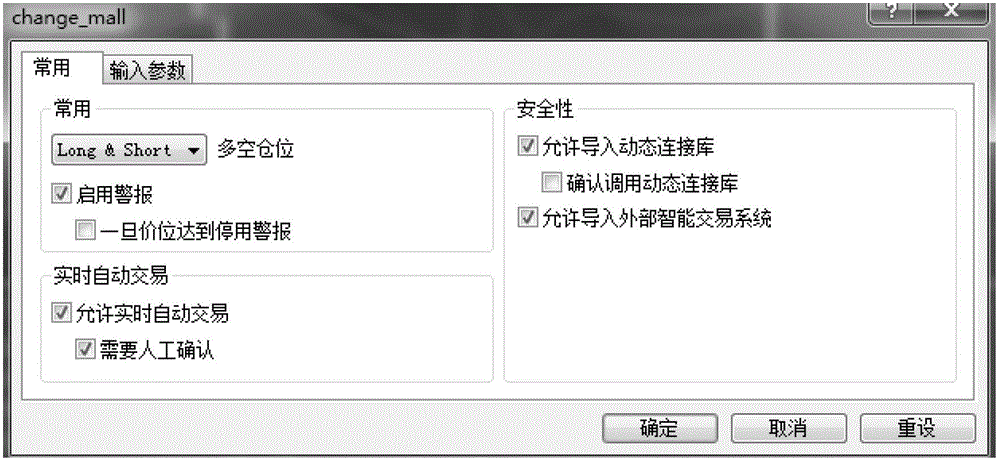

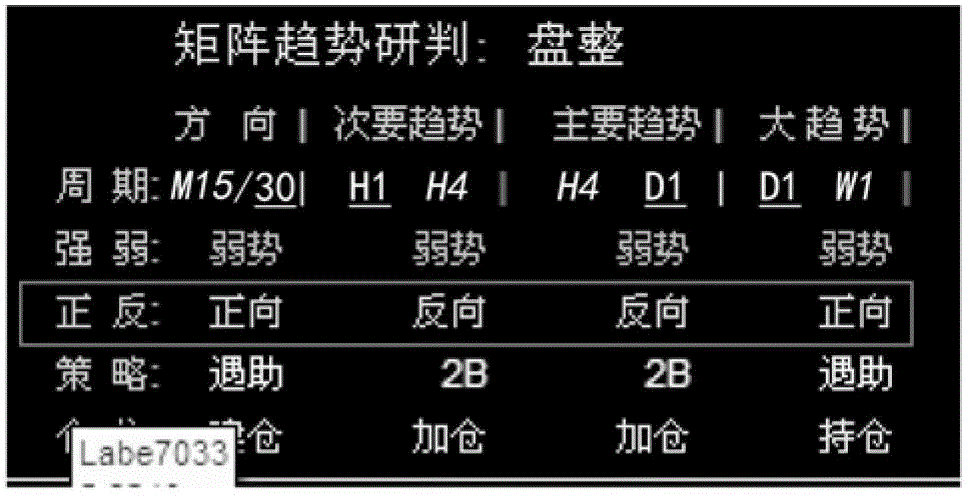

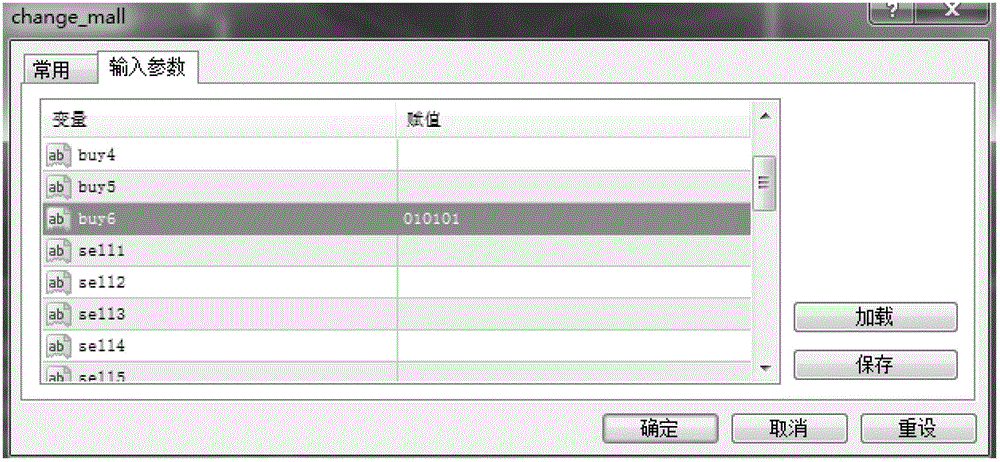

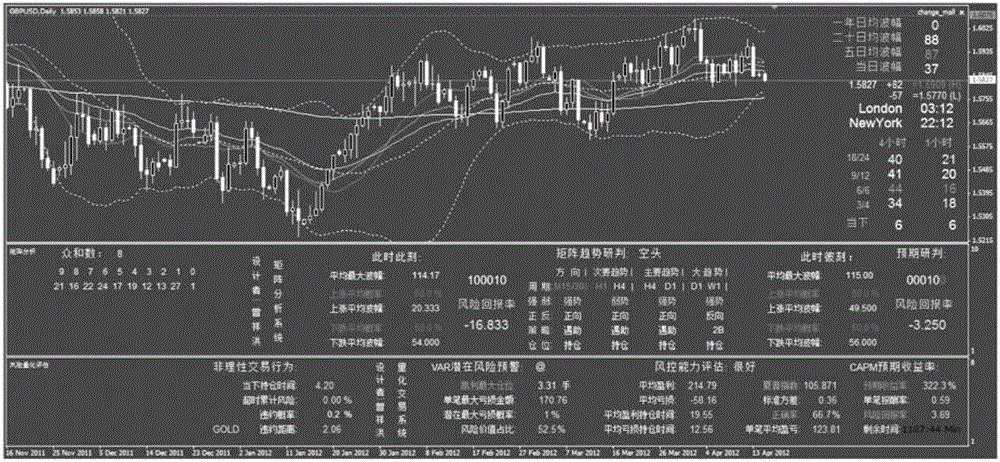

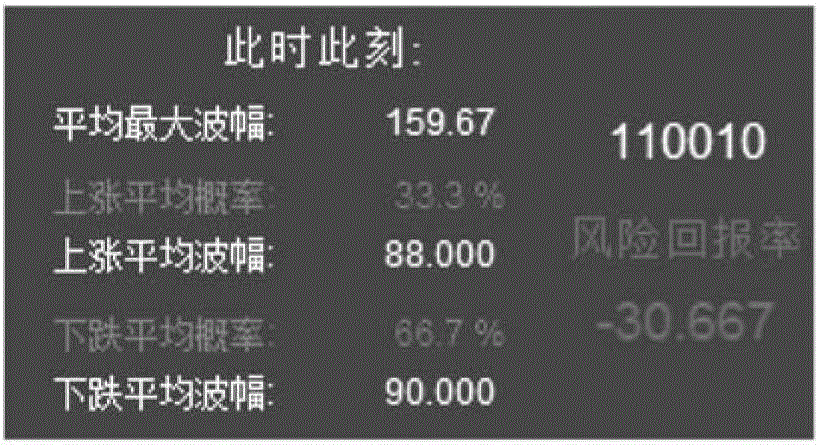

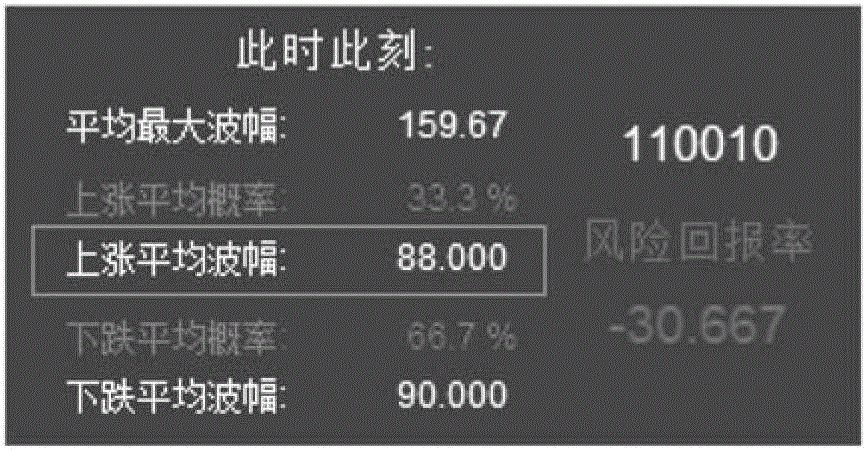

Matrix quantitative analysis method in intelligent transaction and system thereof

ActiveCN102866984AVerify validityKeep Profitable SecretsFinanceComplex mathematical operationsEvaluation systemAnalysis method

The invention discloses a matrix quantitative analysis method in intelligent transaction and a system thereof. The method comprises the following steps of: 1, establishing a database for matrix quantitative analysis, and determining a time period from the database, wherein the length of the period can be set through parameters of a matrix; 2, analyzing historical data, i.e., firstly counting average probability and average wave amplitude for highs and lows of a matrix with the same arrangement order in a next time period and then calculating market risk return rates of different periods respectively; 3, determining a transaction strategy according to the market risk return rate of the matrix in the current time period; 4, calling an intelligent transaction program according to the transaction strategy and starting automatic transaction; and 5, calling a risk evaluation system to evaluate a historical transaction record made by an intelligent transaction program to provide a risk grade for a risk of a transaction account, calculating a default point by using a discrimination model, and then calculating a default distance and default probability of the risk grade of the account through a KMV (Credit Monitor Model).

Owner:BEIJING GZT NETWORK TECH

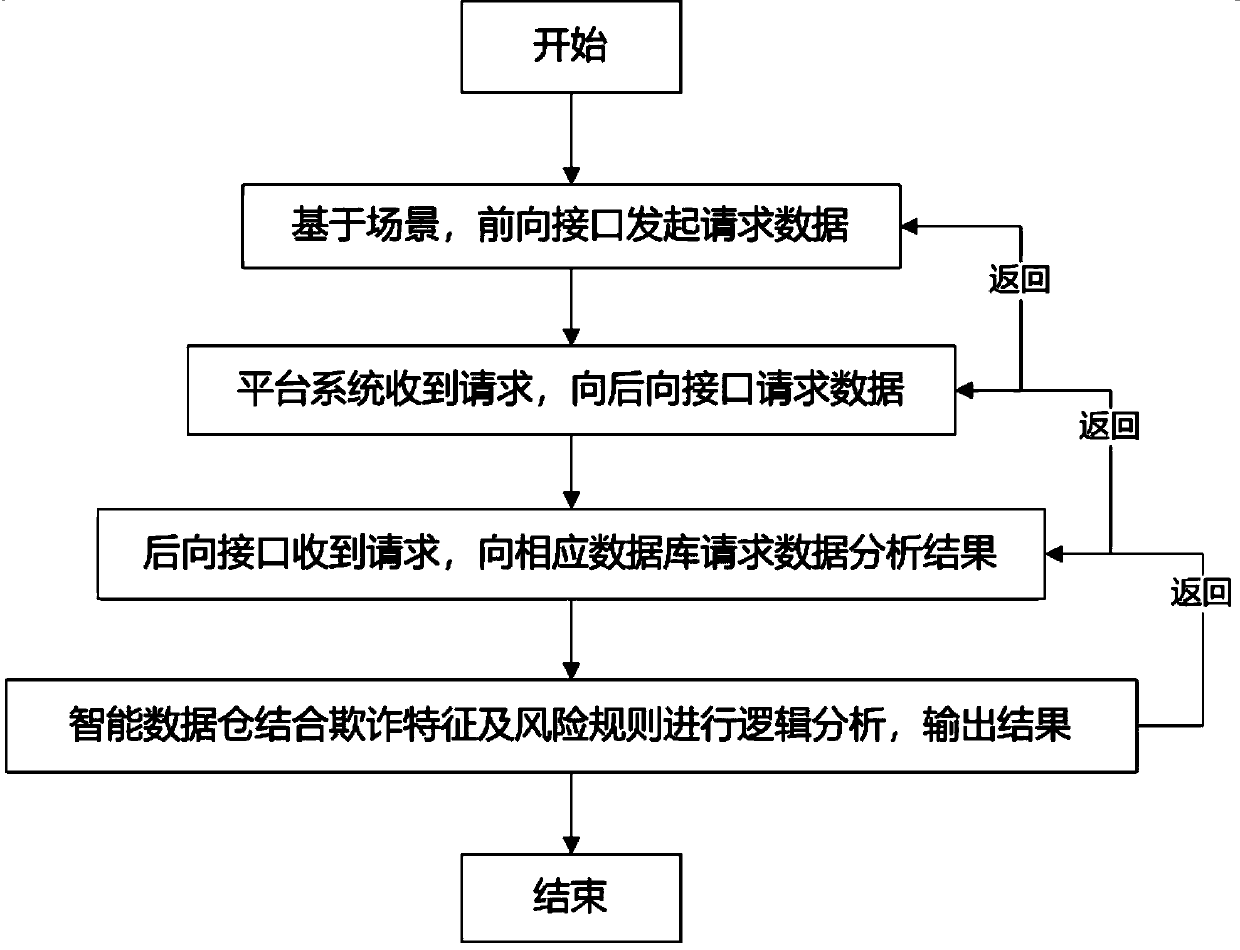

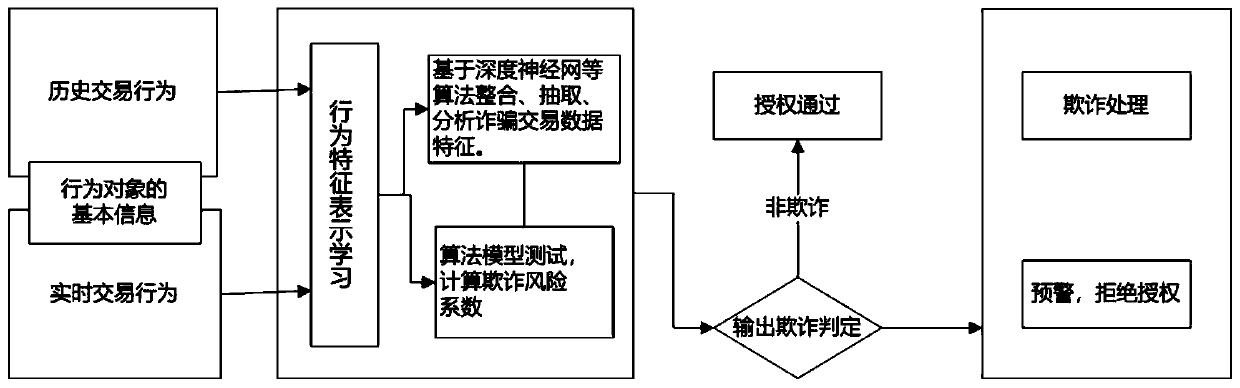

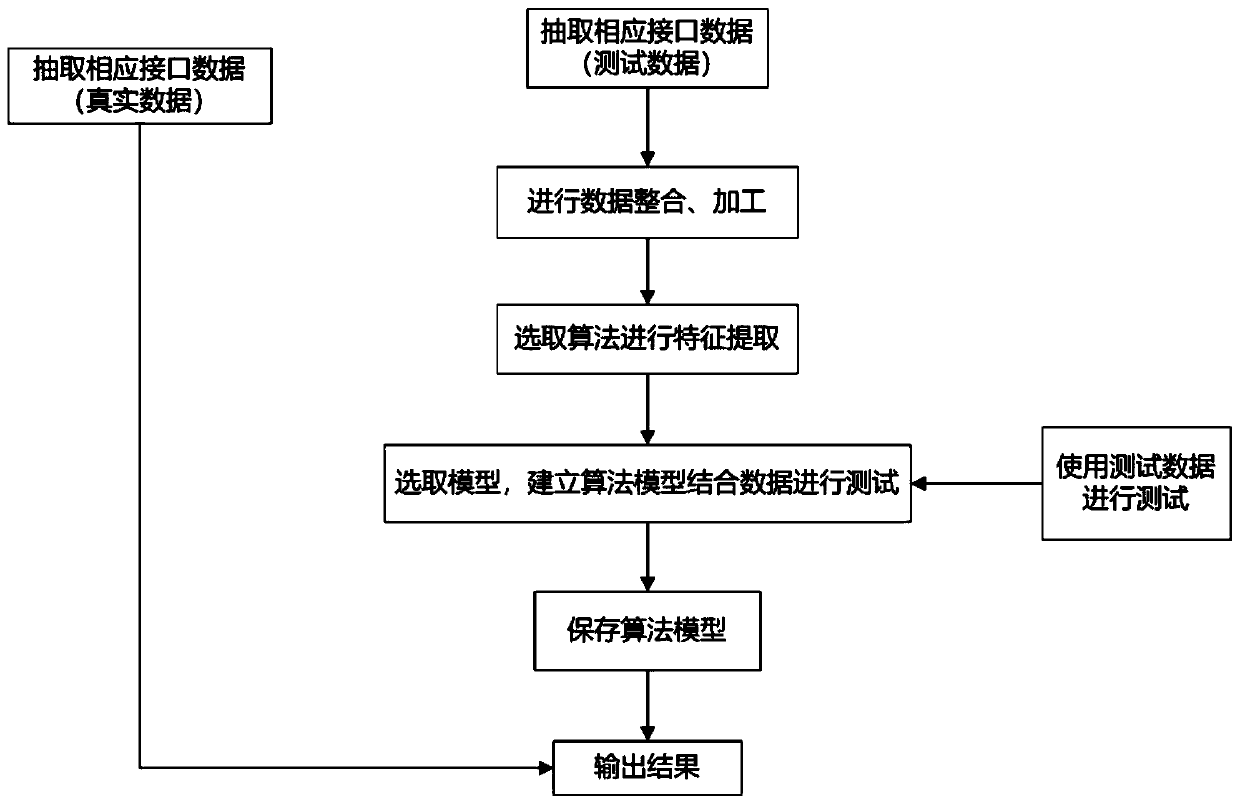

System and method for realizing intelligent early warning of fraudulent transactions

PendingCN110148001AReal-time identificationEfficient identificationFinanceProtocol authorisationProtocol processingData source

The invention relates to a system and a method for realizing intelligent early warning of fraudulent transactions, the system comprises a protocol processing layer, a capability opening layer, a security control layer, a scene combination layer, an operation management layer and a network management layer, and the method comprises the following steps: fusing multi-source heterogeneous data; performing complex multi-source behavior feature modeling based on deep learning; performing anti-fraud intelligent identification based on incremental learning; constructing and analyzing a fraud behaviorobject association network map based on deep learning of the graph structure; constructing and reasoning an anti-fraud rule knowledge graph; performing decision engine construction. The technical problems that linkage between data sources of an existing anti-fraud transaction technology model is insufficient, and the fraud rule feature networked optimization requirement cannot be met can be solved.

Owner:上海欣方智能系统有限公司 +1

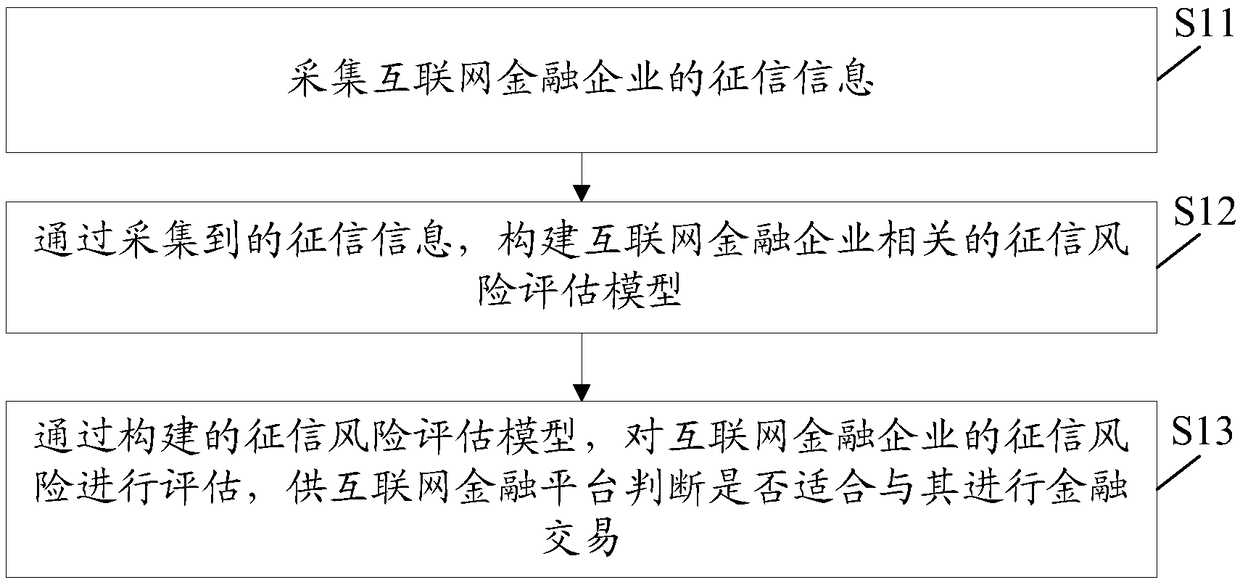

Internet financial enterprise credit risk analysis method and system based on big data

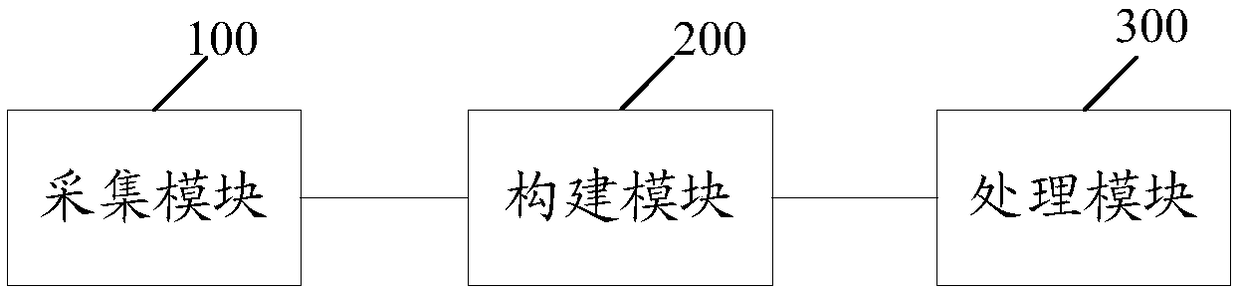

InactiveCN108629686AImprove risk control abilityReduce the risk of problemsFinanceFinancial tradingRisk Control

The invention discloses an internet financial enterprise credit risk analysis method and system based on big data. The method comprises the steps that the credit information of an internet financial enterprise is collected; a credit risk assessment model related to the internet financial enterprise is constructed through the collected credit information; a credit risk assessment model related to the internet financial enterprise is constructed; the constructed credit risk assessment model is used to assess the credit risk of the internet financial enterprise; and an internet financial platformdetermines whether financial transactions with the internet financial enterprise is suitable. According to the internet financial enterprise credit risk analysis method based on big data, the creditof the internet financial enterprise can be accurately evaluated; accurate and effective credit assessment is provided for the internet financial platform; the risk control ability of the internet financial platform is improved; and the risk of the problems of the internet financial enterprise is reduced.

Owner:NAT COMP NETWORK & INFORMATION SECURITY MANAGEMENT CENT

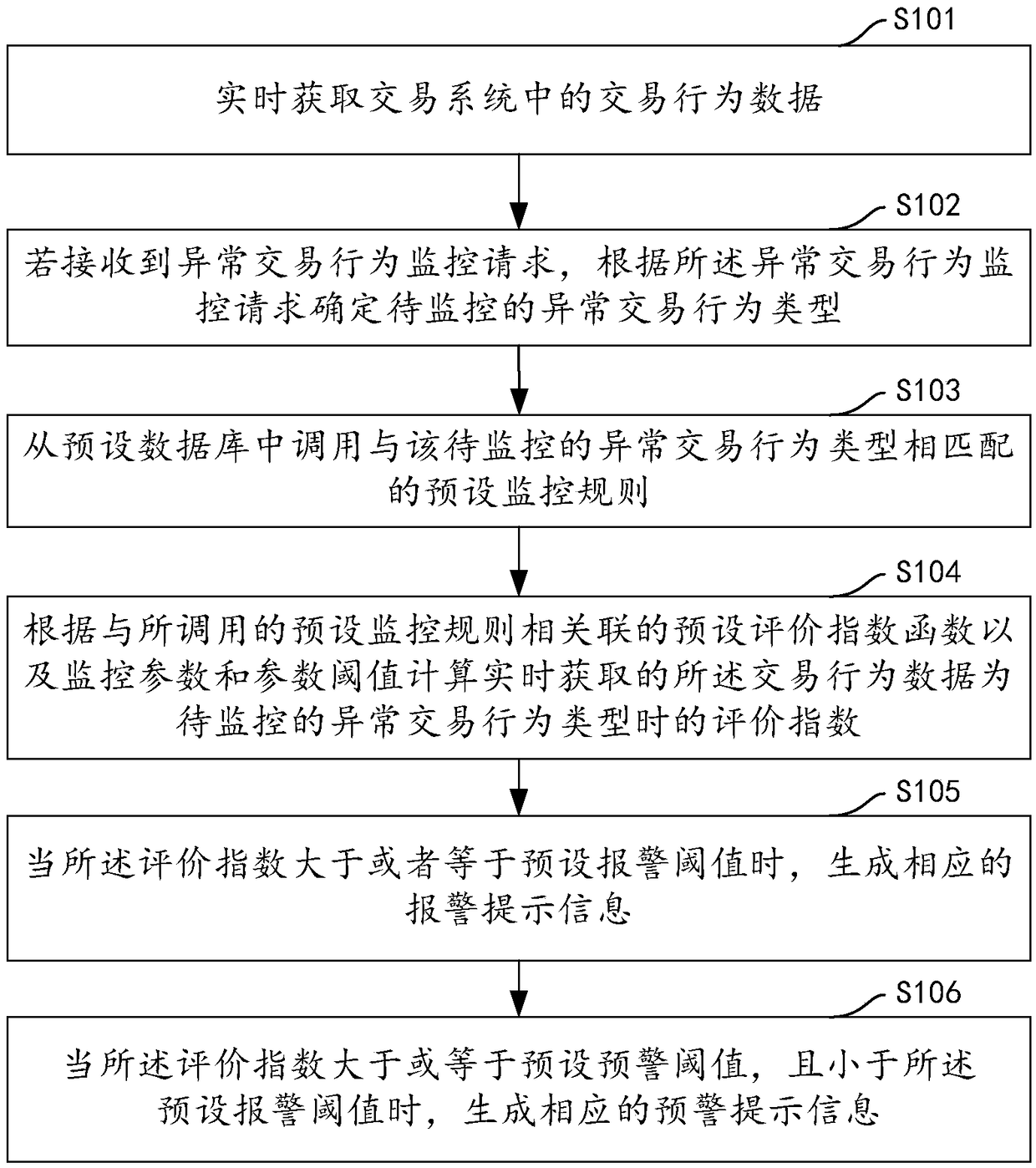

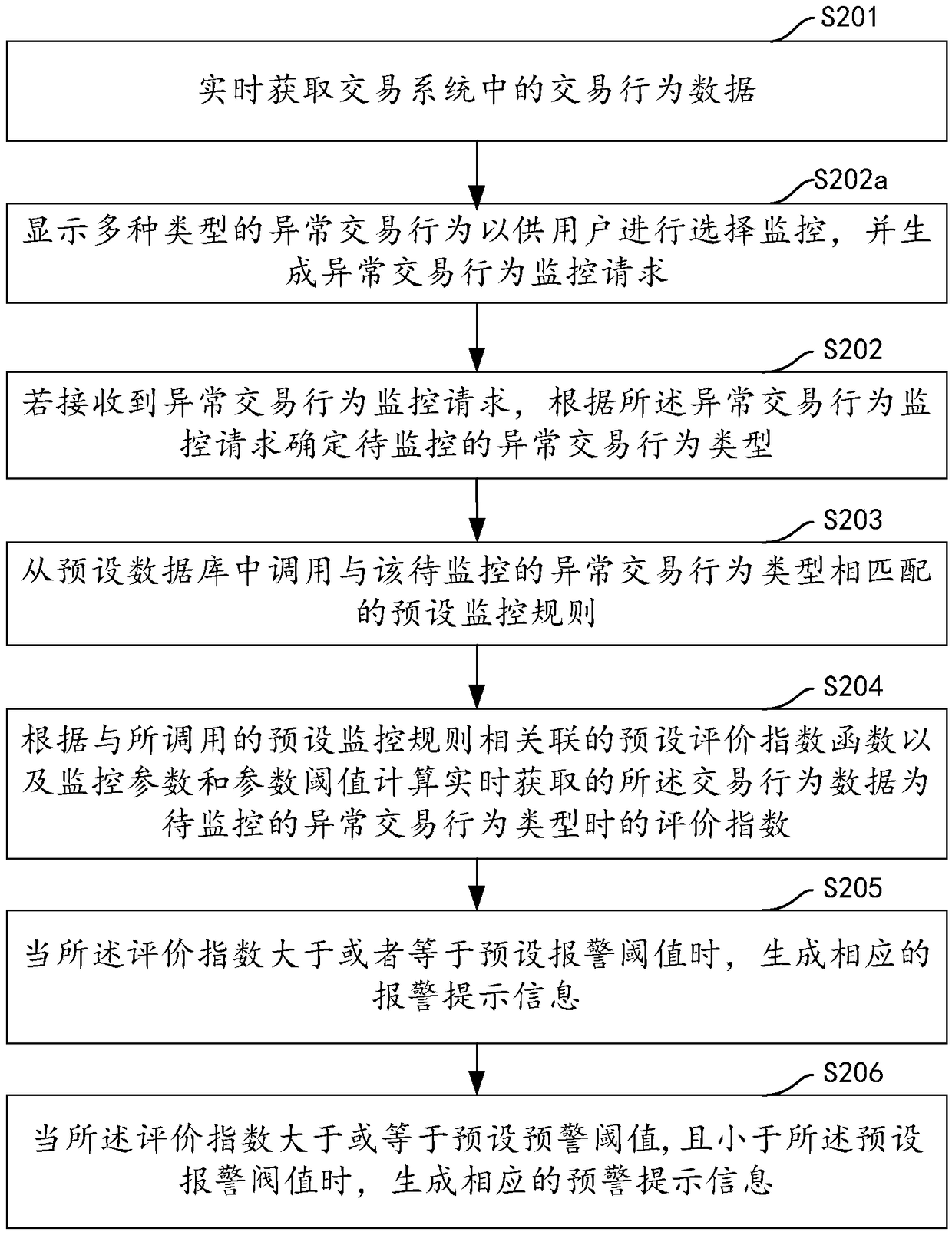

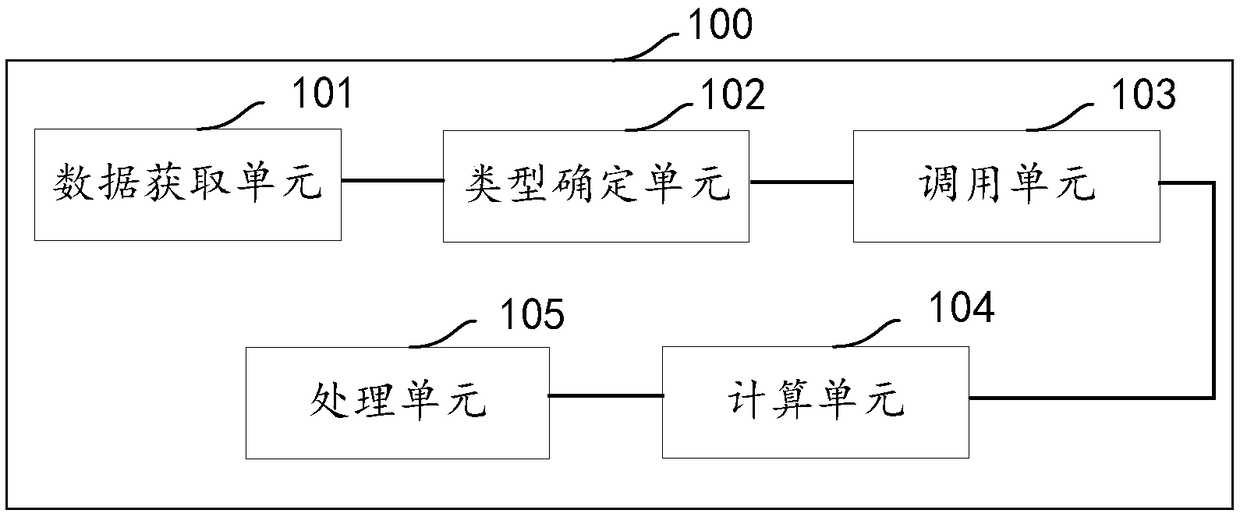

Abnormal trading behavior monitoring method, device, computer device and storage medium

ActiveCN109509097AImprove risk control abilityImprove service capabilitiesFinanceData libraryBehavior monitoring

The embodiment of the invention discloses a method, a device, a computer device and a storage medium for monitoring abnormal trading behavior, wherein, the method comprises the following steps of: acquiring trading behavior data in a trading system in real time; If the abnormal transaction behavior monitoring request is received, determining the abnormal transaction behavior type to be monitored according to the abnormal transaction behavior monitoring request; Calling a preset monitoring rule matching with the abnormal transaction behavior type to be monitored from a preset database; Calculating an evaluation index when the real-time acquired transaction behavior data is an abnormal transaction behavior type to be monitored according to a preset evaluation exponential function associatedwith the called preset monitoring rule and monitoring parameters and parameter thresholds; When the evaluation index is greater than or equal to a preset alarm threshold, generating corresponding alarm prompt information. The invention can quantify the abnormality degree of the transaction behavior, so that the supervisor continuously monitors all the transaction behavior of the customer, and classifies and handles the transaction behavior according to the abnormality degree.

Owner:深圳华锐分布式技术股份有限公司

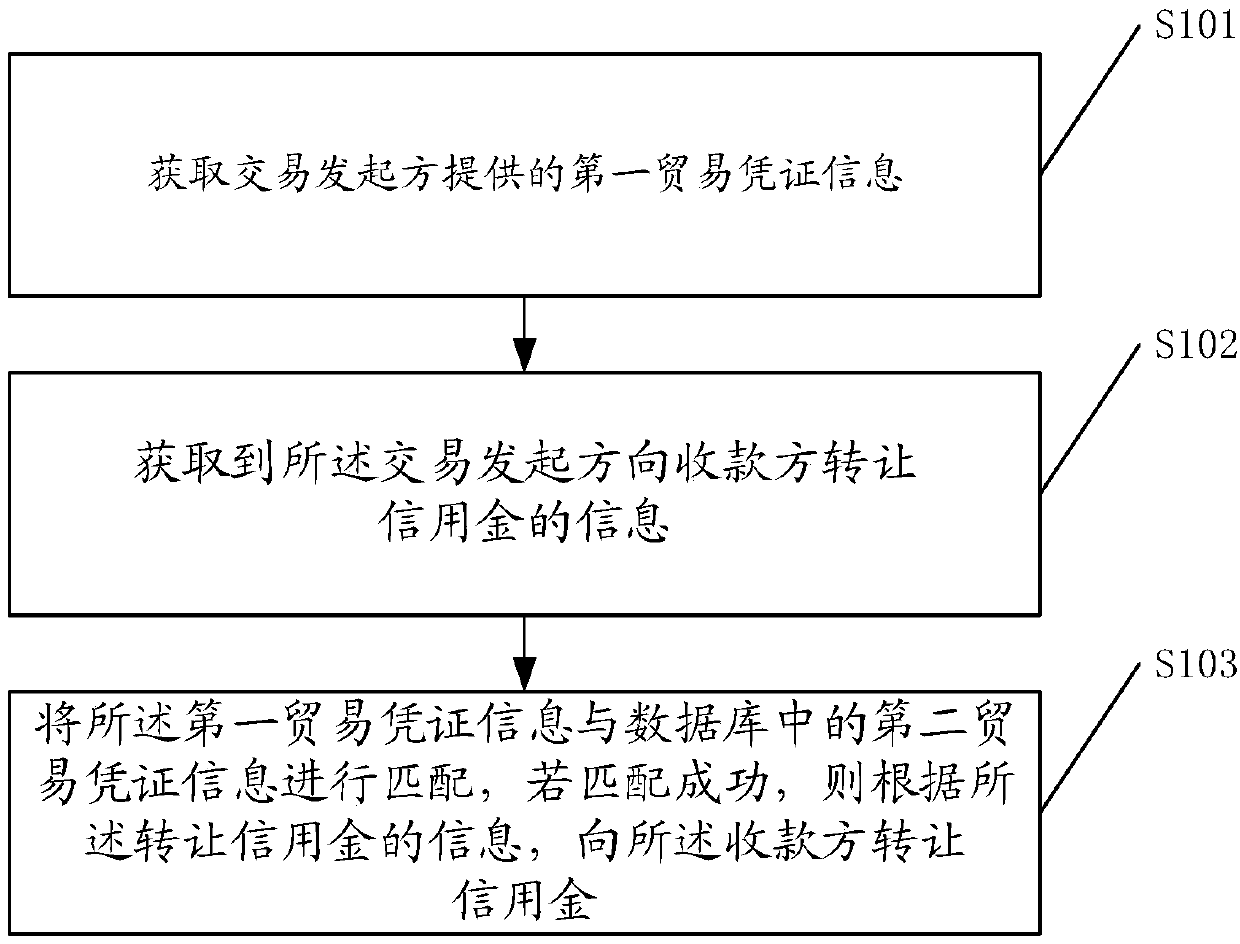

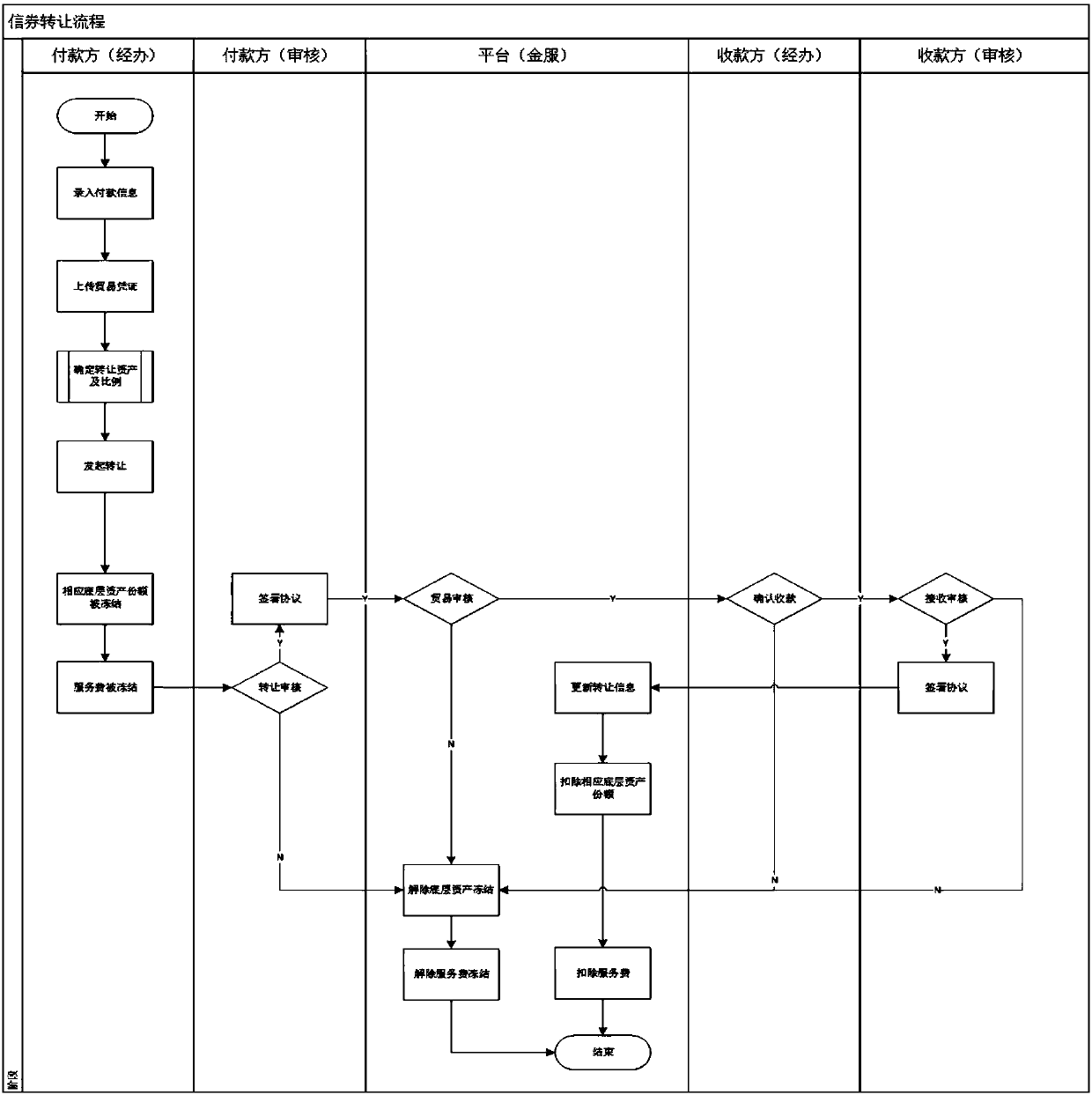

Management method and platform for credit fund transaction based on supply chain finance

InactiveCN107767269ATransfer fastImprove risk control abilityFinanceRisk ControlFinancial transaction

The invention relates to a management method and platform for a credit fund transaction based on supply chain finance. The management method comprises the steps that a financial transaction platform acquires trade credential information provided by a transaction initiator; information that the transaction initiator transfers credit fund to a payee is acquired; and the transaction initiator is audited according to the transaction credential information, and if the transaction initiator passes the auditing, the credit fund is transferred to the payee according to the credit fund transferring information. According to the invention, auditing is performed according to the trade credential information of the transaction initiator, the fund required by the payee is transferred according to a trade document and the credit fund transferring information in a transaction between enterprises, fast transfer between chain enterprises in the financial transaction process is realized, and the risk control ability is improved at the same time.

Owner:人民金服金融信息服务(北京)有限公司

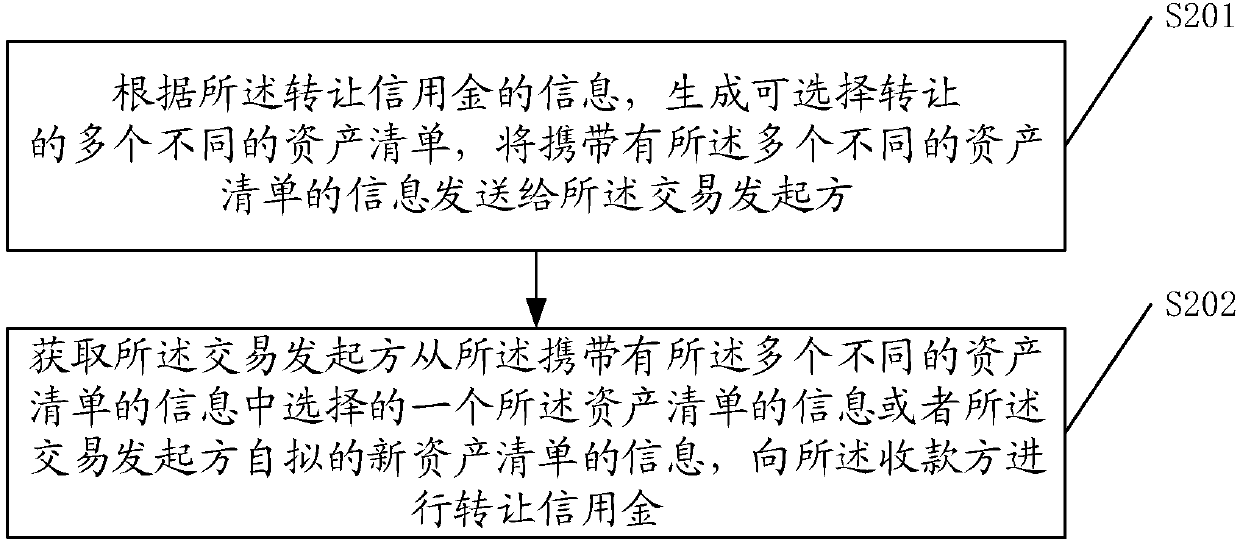

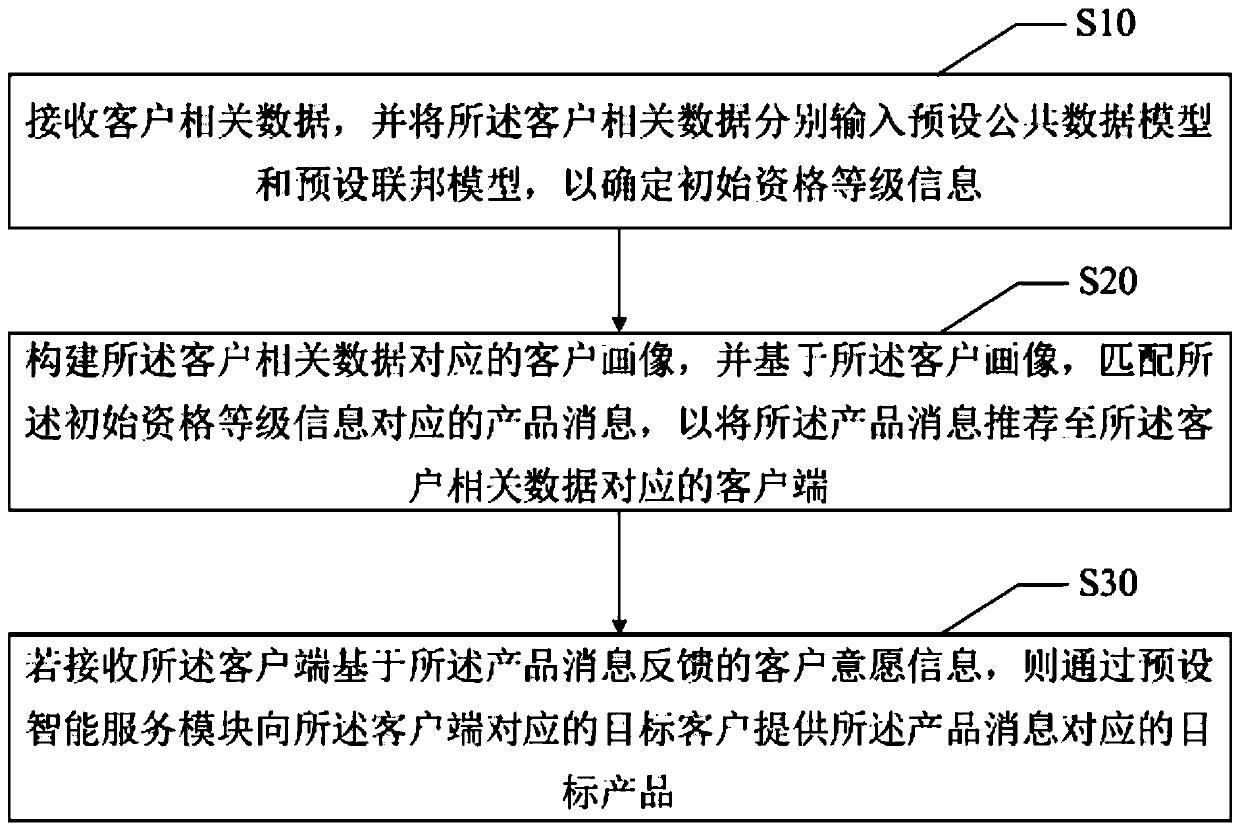

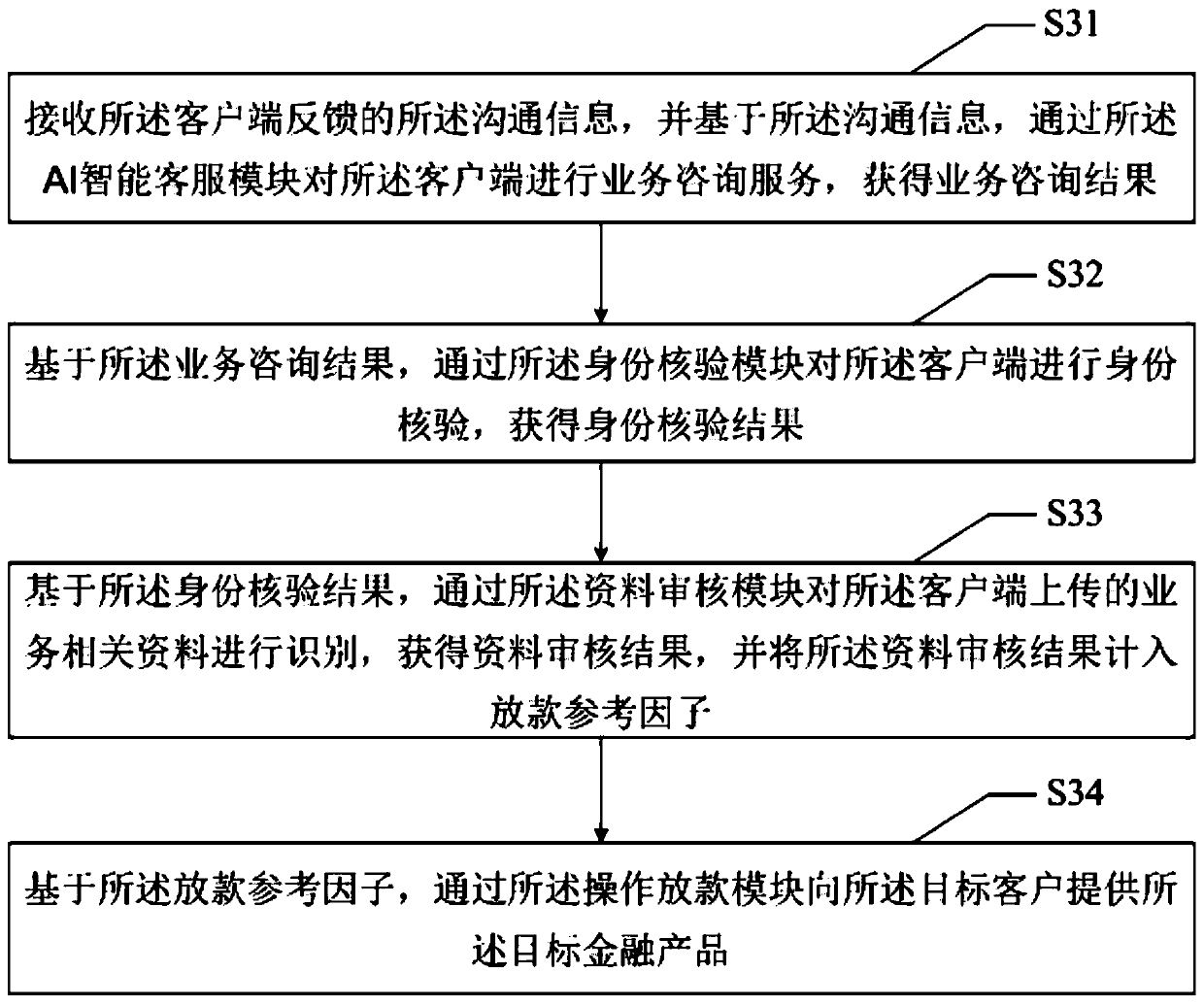

Product service full-chain driving method and device, and readable storage medium

PendingCN111383094AImprove conversion efficiencyImprove risk control abilityDigital data information retrievalFinanceService efficiencyIndustrial engineering

The invention discloses a product service full-chain driving method and device, and a readable storage medium. The product service full-chain driving method comprises the following steps: performing full-chain driving on a product; receiving customer-related data, respectively inputting the customer related data into a preset public data model and a preset federation model; determining initial qualification grade information; constructing a customer portrait corresponding to the customer related data, the client portrait is obtained; matching a product message corresponding to the initial qualification level information, and sending the product message to a client corresponding to the client related data, and if client willingness information fed back by the client based on the product message is received, providing a target product corresponding to the product message to a target client corresponding to the client through a preset intelligent service module. The technical problems oflow product service efficiency and high cost are solved.

Owner:WEBANK (CHINA)

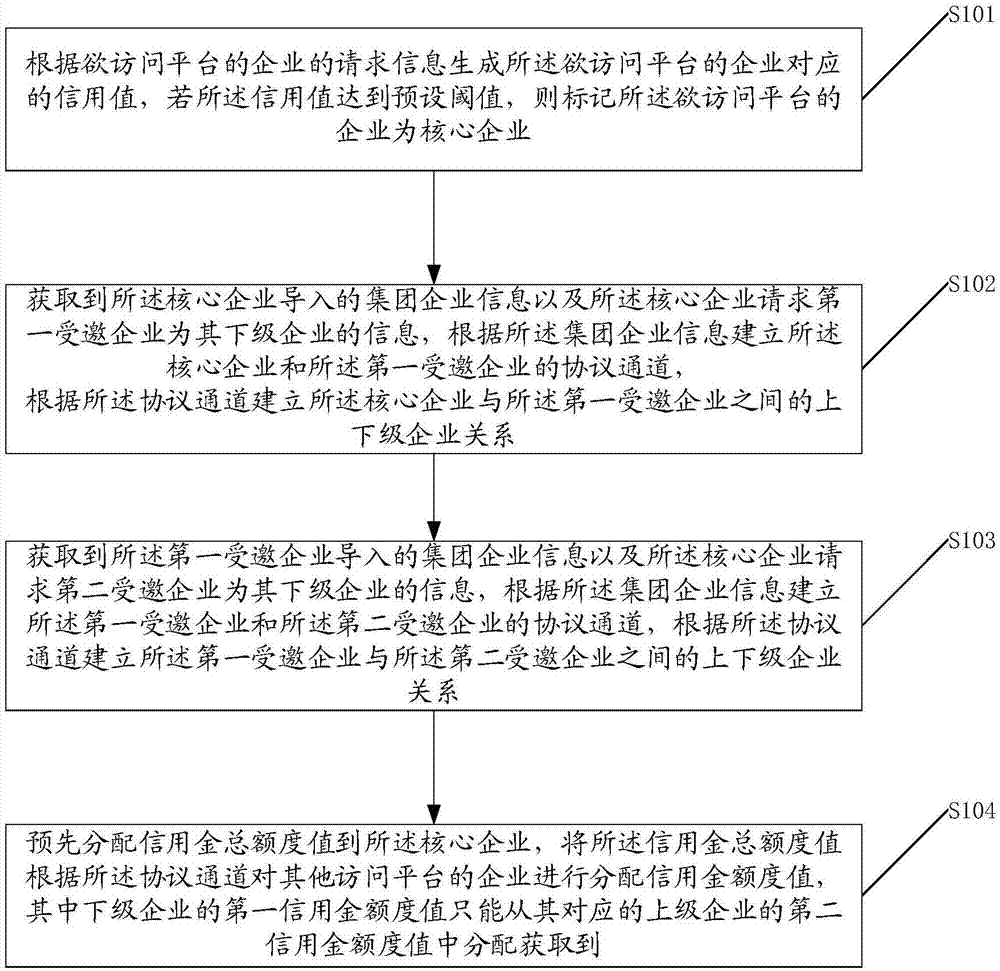

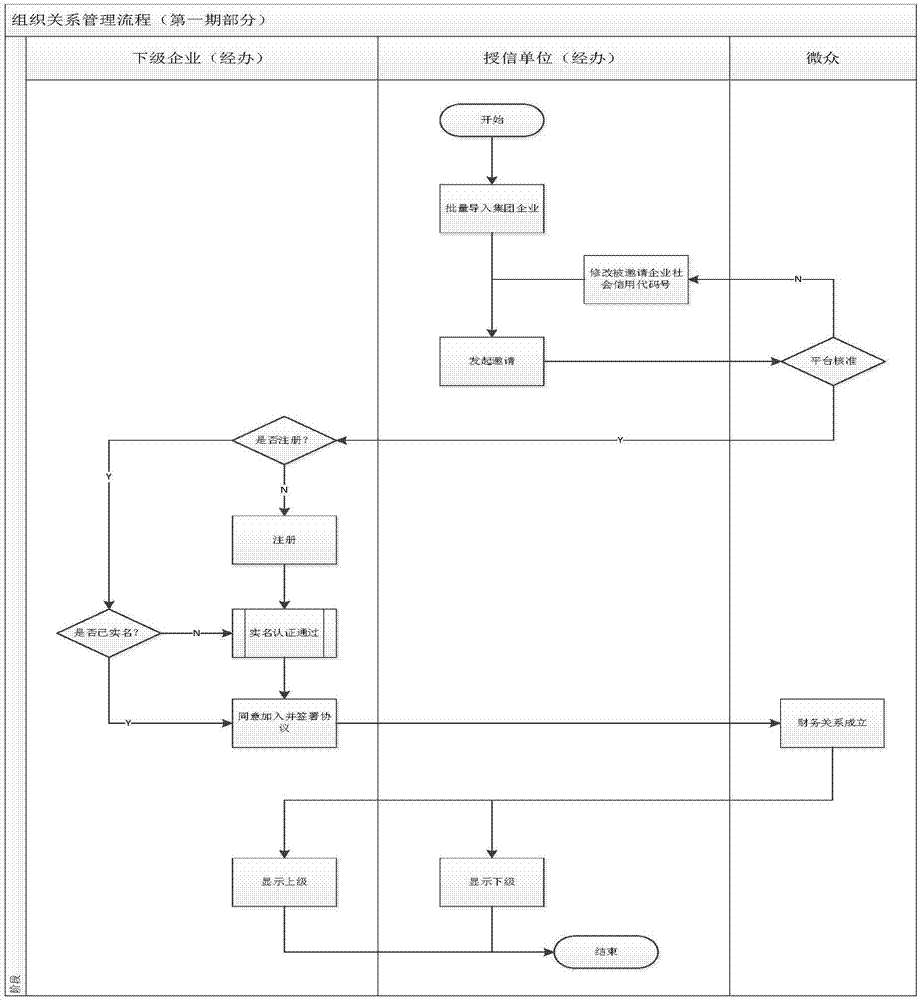

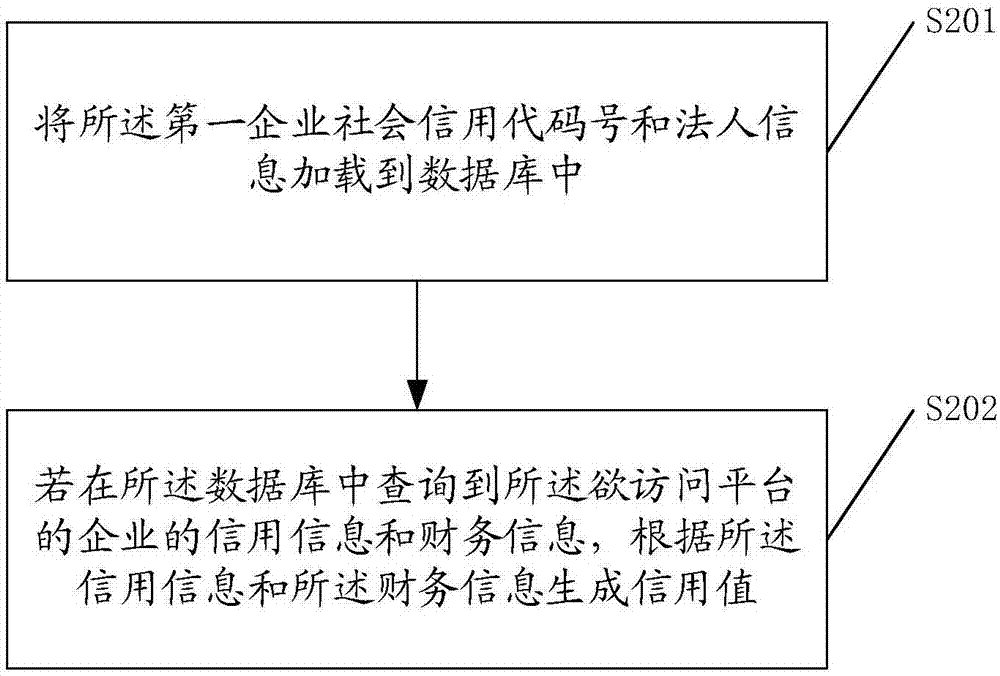

Multilevel relation management method and platform for credit money allocation

The invention relates to a multilevel relation management method and a platform for credit money allocation. The method comprises steps: through analyzing the credit value of an enterprise which is about to access the platform, the enterprise is marked as a core enterprise, and according to a protocol channel, an upper-lower enterprise relation between the core enterprise and a first invited enterprise is built; an upper-lower enterprise relation between the first invited enterprise and a second invited enterprise is built; the total credit money amount value is pre-allocated to the core enterprise, and allocation of the credit money amount value is carried out on other enterprises which access the platform according to the protocol channel. Through building the upper-lower enterprise relation, the allocation of the credit money amount value between upper and lower levels of enterprises is managed, the risk control ability is improved, the credit risks are reduced, the supervision strength is enhanced, the credit money amount allocation ability is further improved, and interests and needs of the enterprise are met.

Owner:人民金服金融信息服务(北京)有限公司

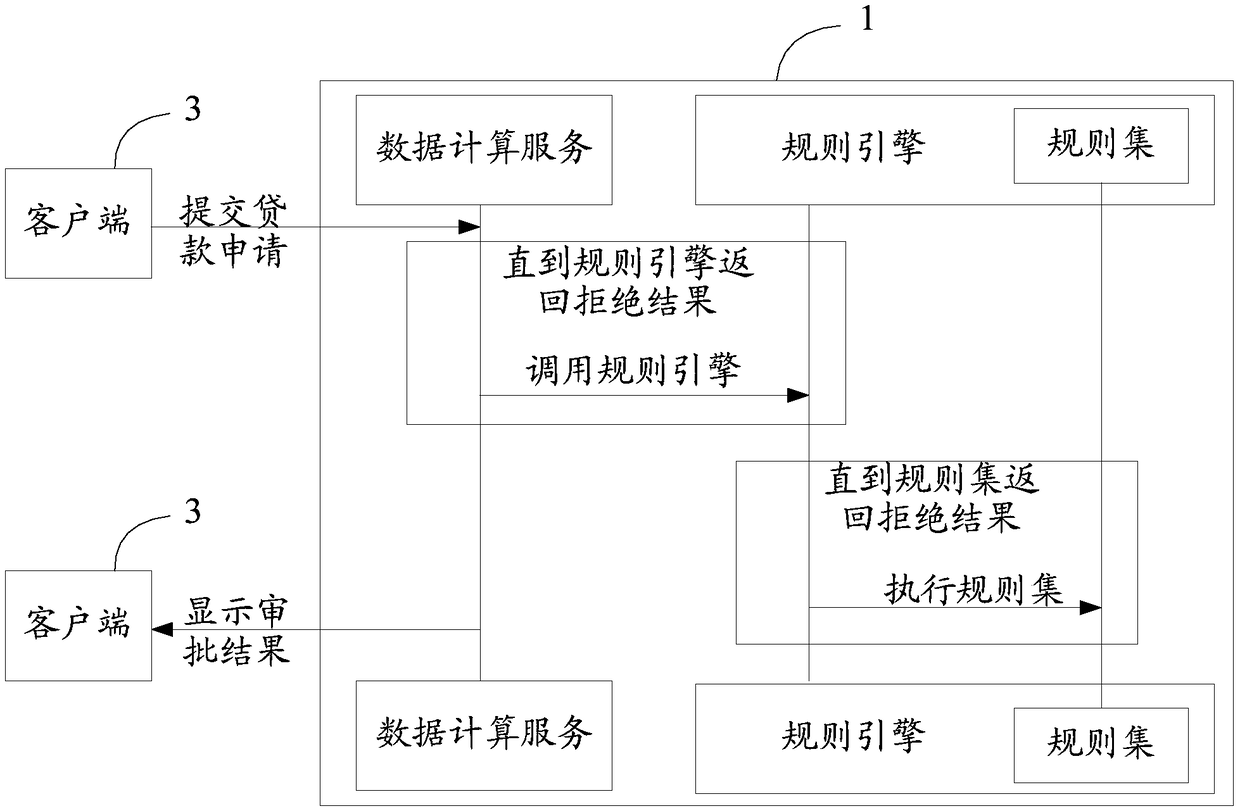

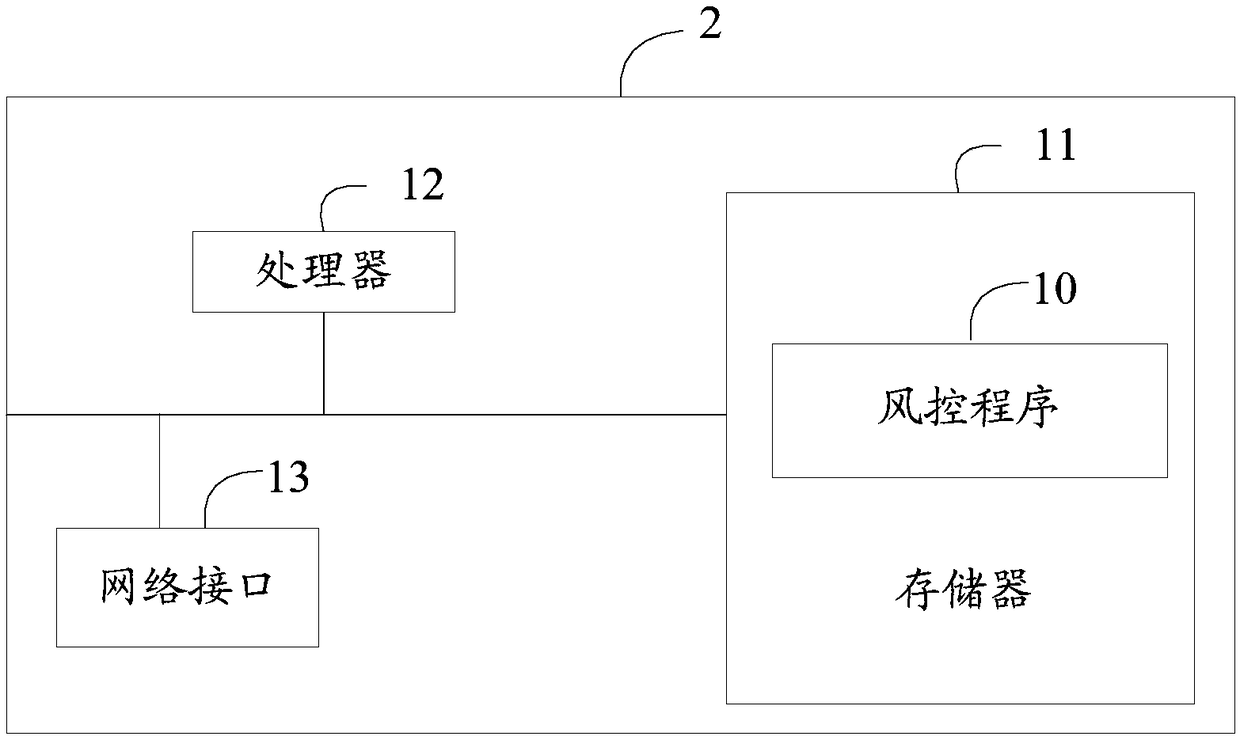

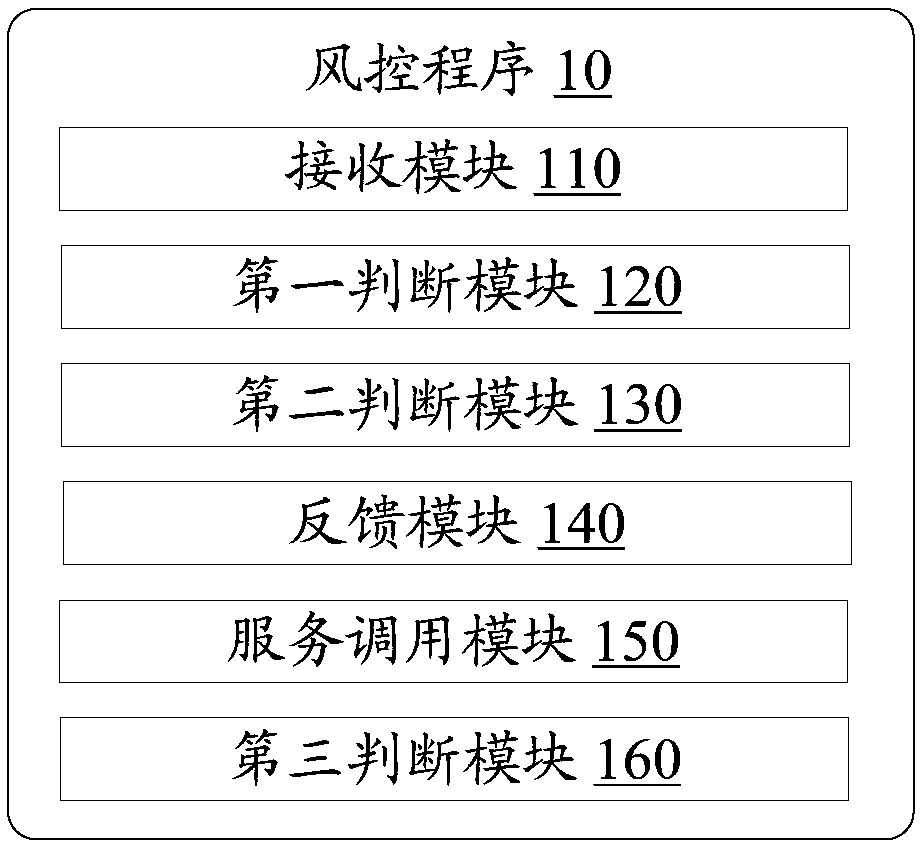

Pneumatic control method, device and computer-readable storage medium

InactiveCN109146671ASmall amount of calculationTime limit for protectionFinanceResourcesControl dataComputer science

The invention relates to a method for air control, an electronic device and a computer storage medium. In the process of calculating the user's wind control data, the method can call a rule engine many times in real time and combine the corresponding rules to determine whether the next step of the wind control data audit is needed or not, and the subsequent data calculation is stopped when the user's data hits any rejection condition in the rule set. By using the invention, the data cost can be saved, the effect of the wind control and the online examination and approval efficiency can be improved.

Owner:WELAB INFORMATION TECH SHENZHEN LTD

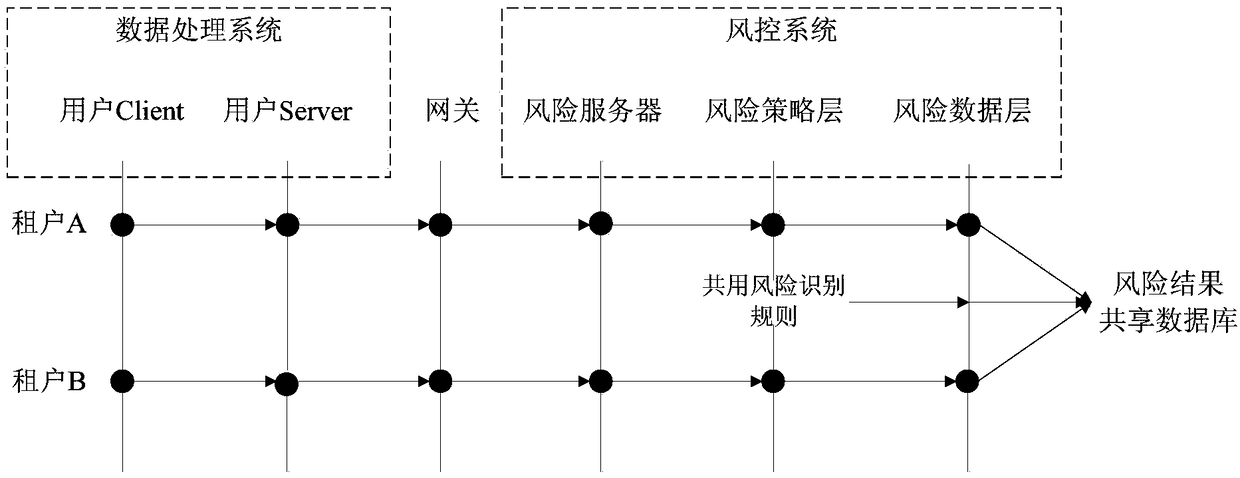

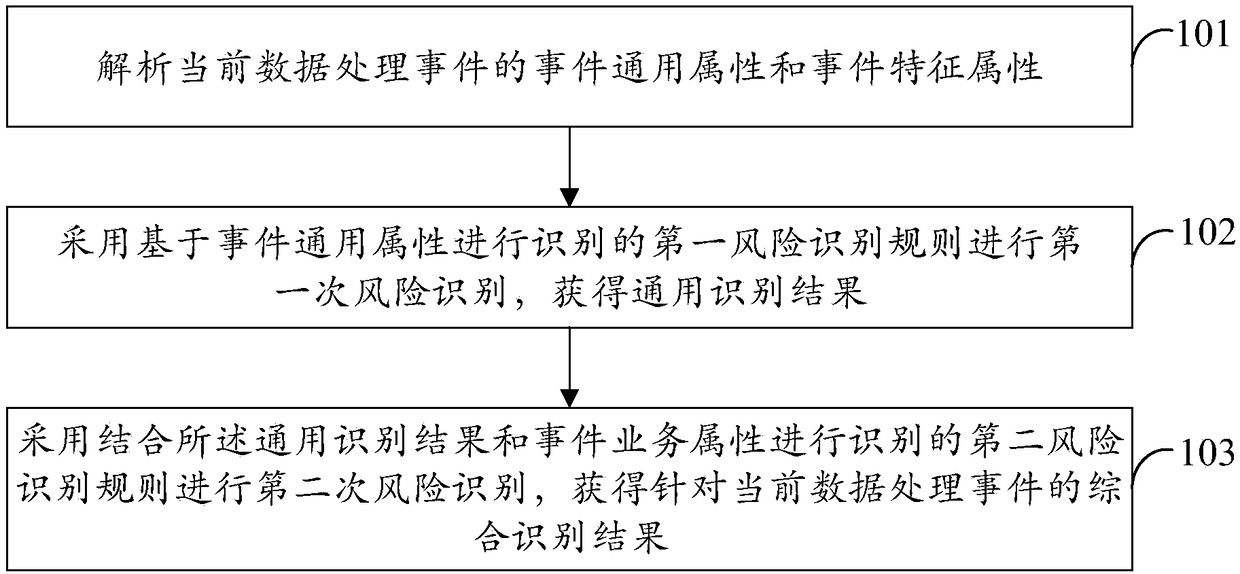

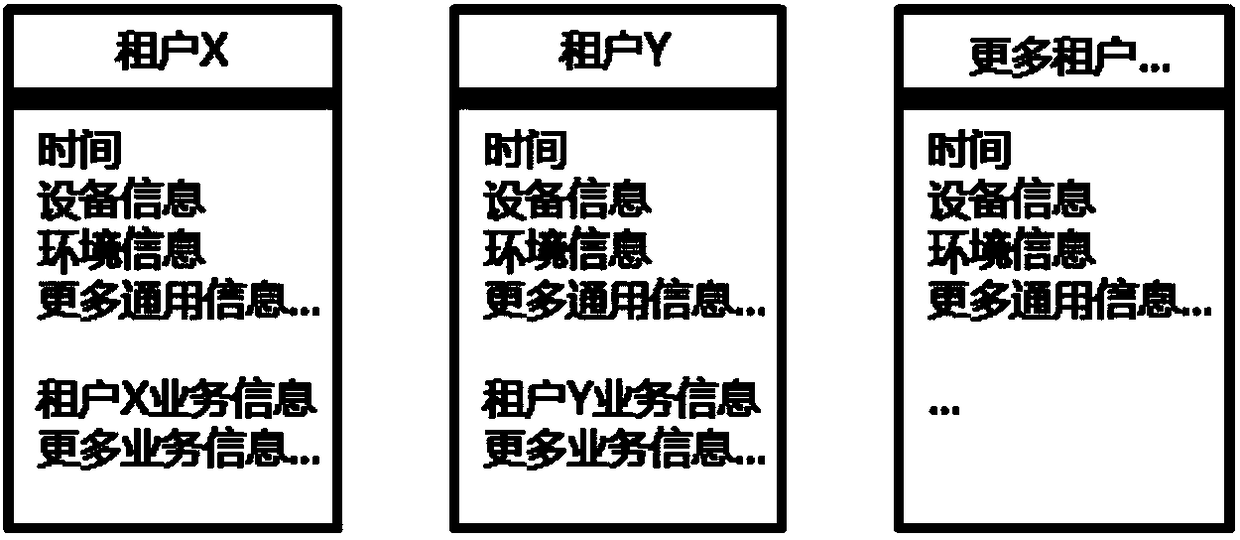

Risk identification method and device for data processing event

ActiveCN108512822AImprove accuracyImprove maintenance efficiencyTransmissionData processing systemRisk Control

The invention discloses a risk identification method and device for a data processing event. The method comprises the following steps: analyzing general event attributes and characteristic event attributes of the current data processing event, wherein the general event attributes are common attributes of data processing events of a plurality of data processing systems, and the characteristic eventattributes are special attributes of the data processing events in the corresponding data processing systems; carrying out a first risk identification through first risk identification rules, in which the identification is based on the general event attributes, so that a general identification result is obtained; and carrying out a second risk identification through second risk identification rules, in which the general identification result and the characteristic event attributes are combined for the identification, so that a comprehensive identification result for the current data processing event is obtained. The method and device provided by the invention has the advantages that the workload for rule configuration and maintenance is greatly reduced, so that the maintenance efficiencyfor risk control services can be improved.

Owner:TAOBAO CHINA SOFTWARE

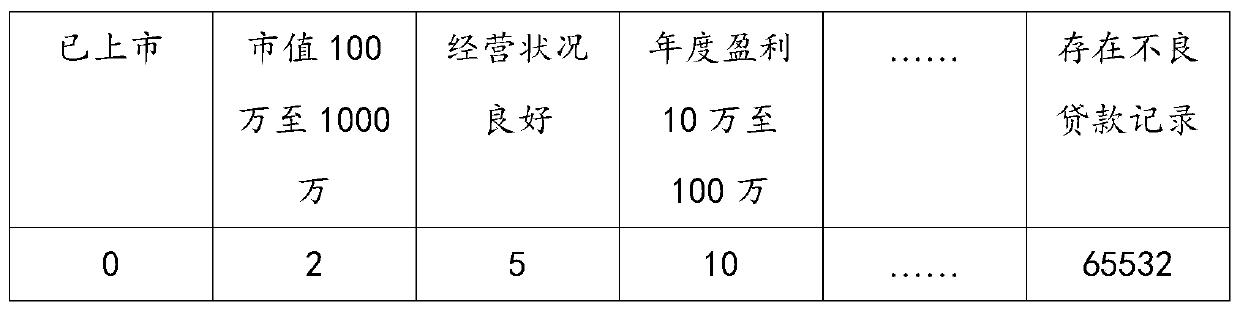

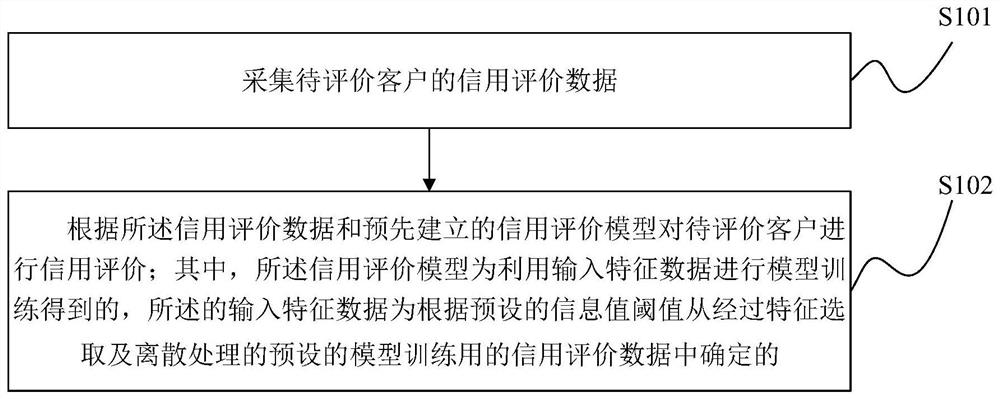

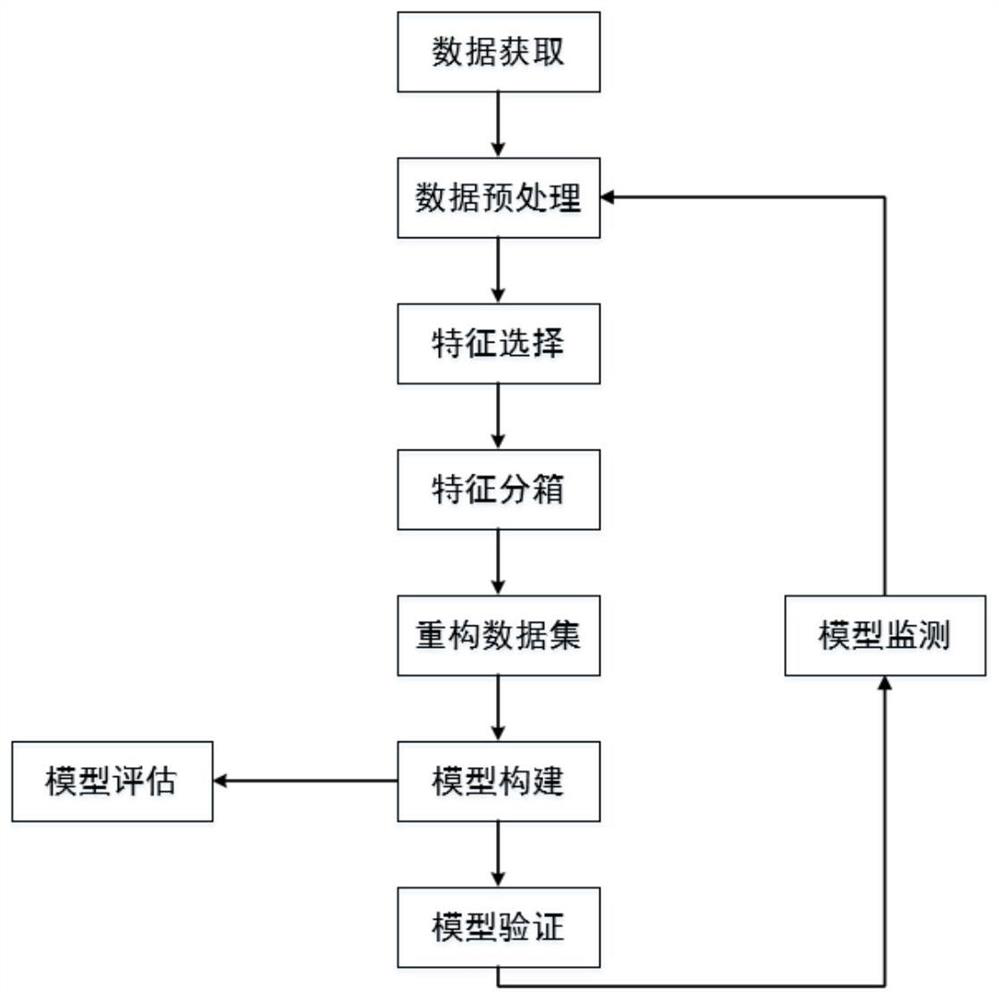

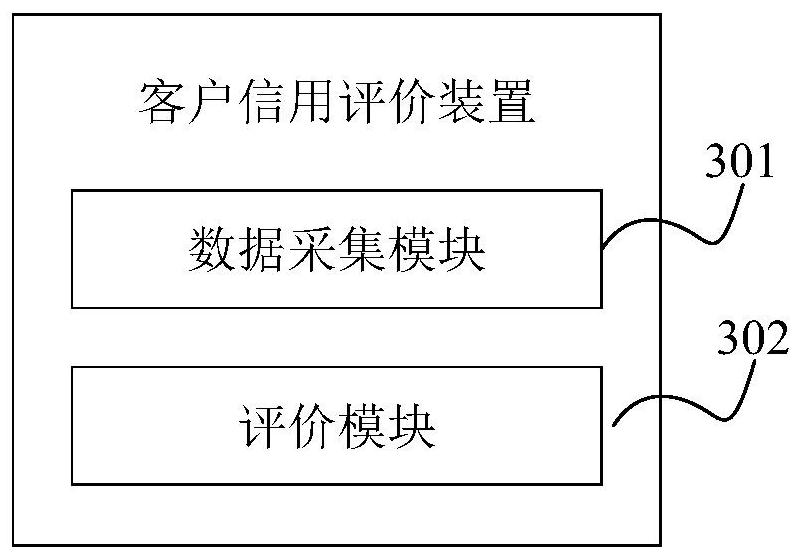

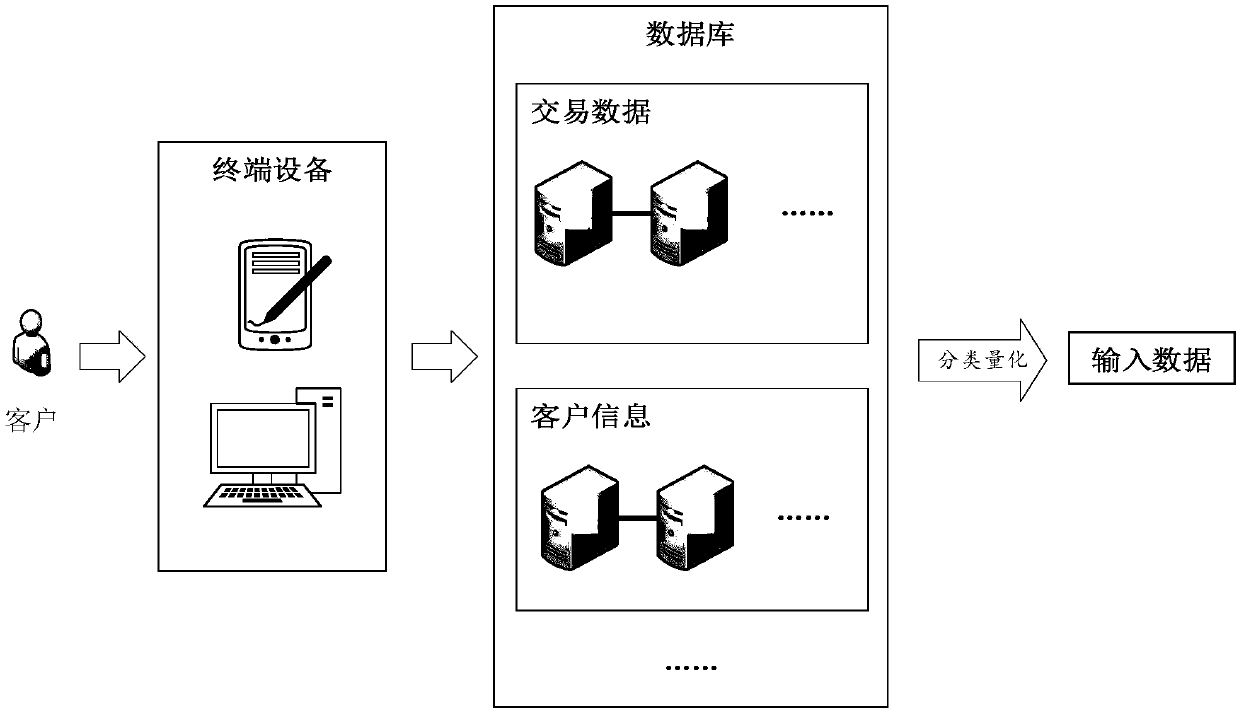

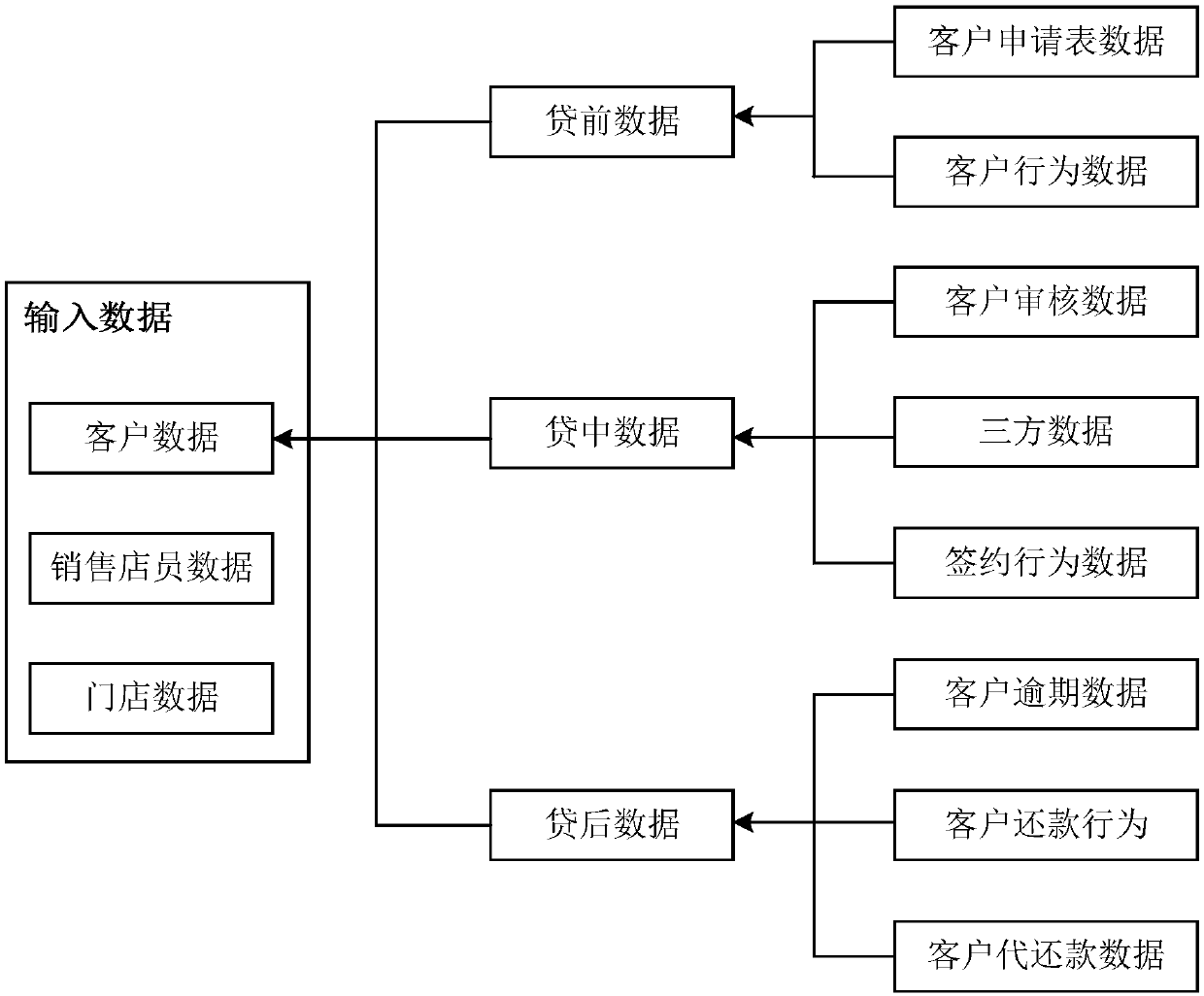

Customer credit evaluation method and device

PendingCN112801775AImprove risk control abilityReduce audit costsFinanceMachine learningData miningFeature selection

The invention provides a customer credit evaluation method and device. The method comprises the steps of collecting credit evaluation data of a to-be-evaluated customer; performing credit evaluation on the to-be-evaluated customer according to the credit evaluation data and a pre-established credit evaluation model, wherein the credit evaluation model is obtained by performing model training by using input feature data, and the input feature data is determined from preset credit evaluation data for model training, which is subjected to feature selection and discrete processing, according to a preset information threshold value. The invention belongs to the field of Internet of Things, can also be used in the financial field, and provides an effective customer credit evaluation method, aiming at credit business in a bank, the bank risk control capability is effectively improved, the bank auditing cost is reduced, and the risk control efficiency and accuracy of the bank are improved.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

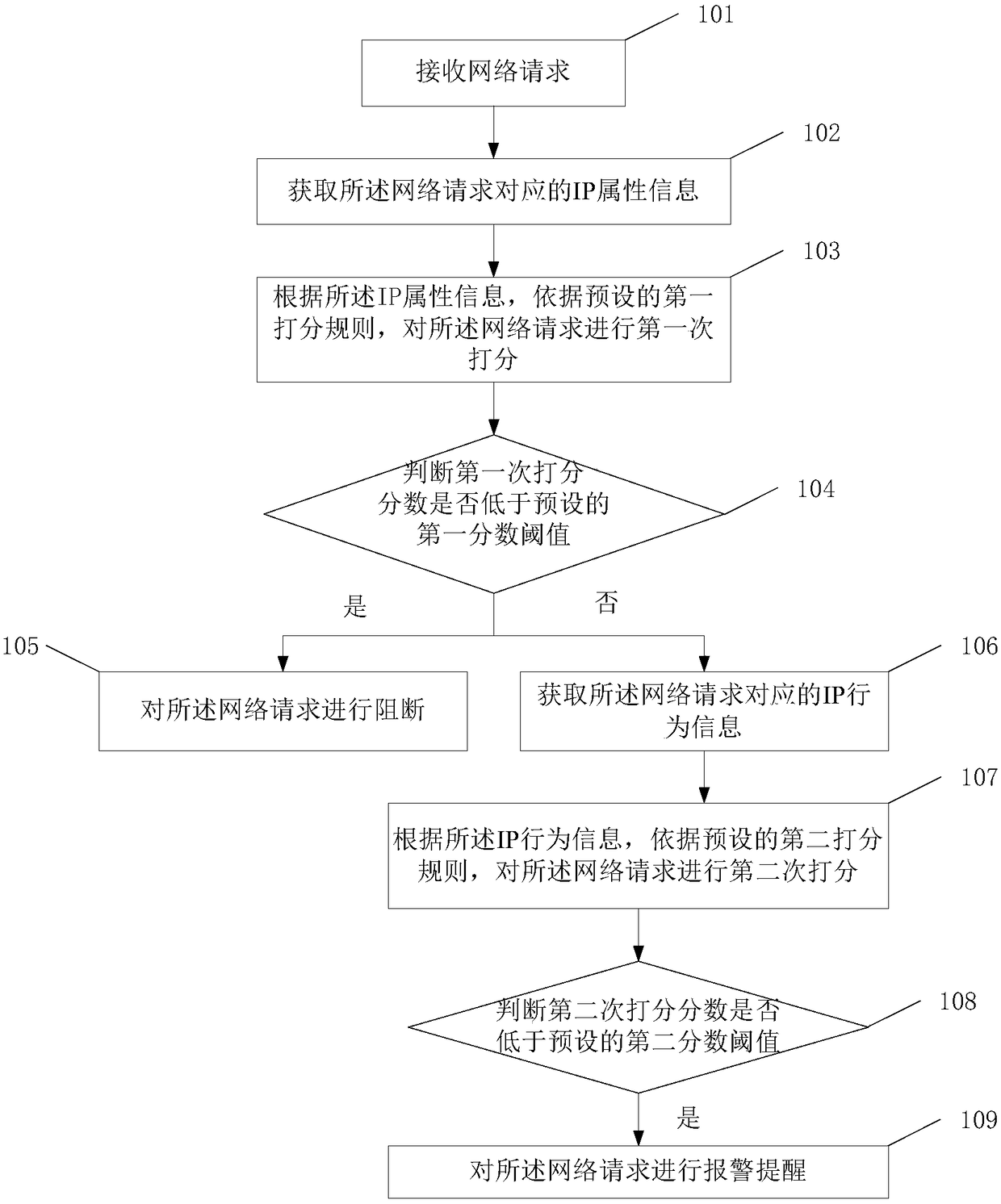

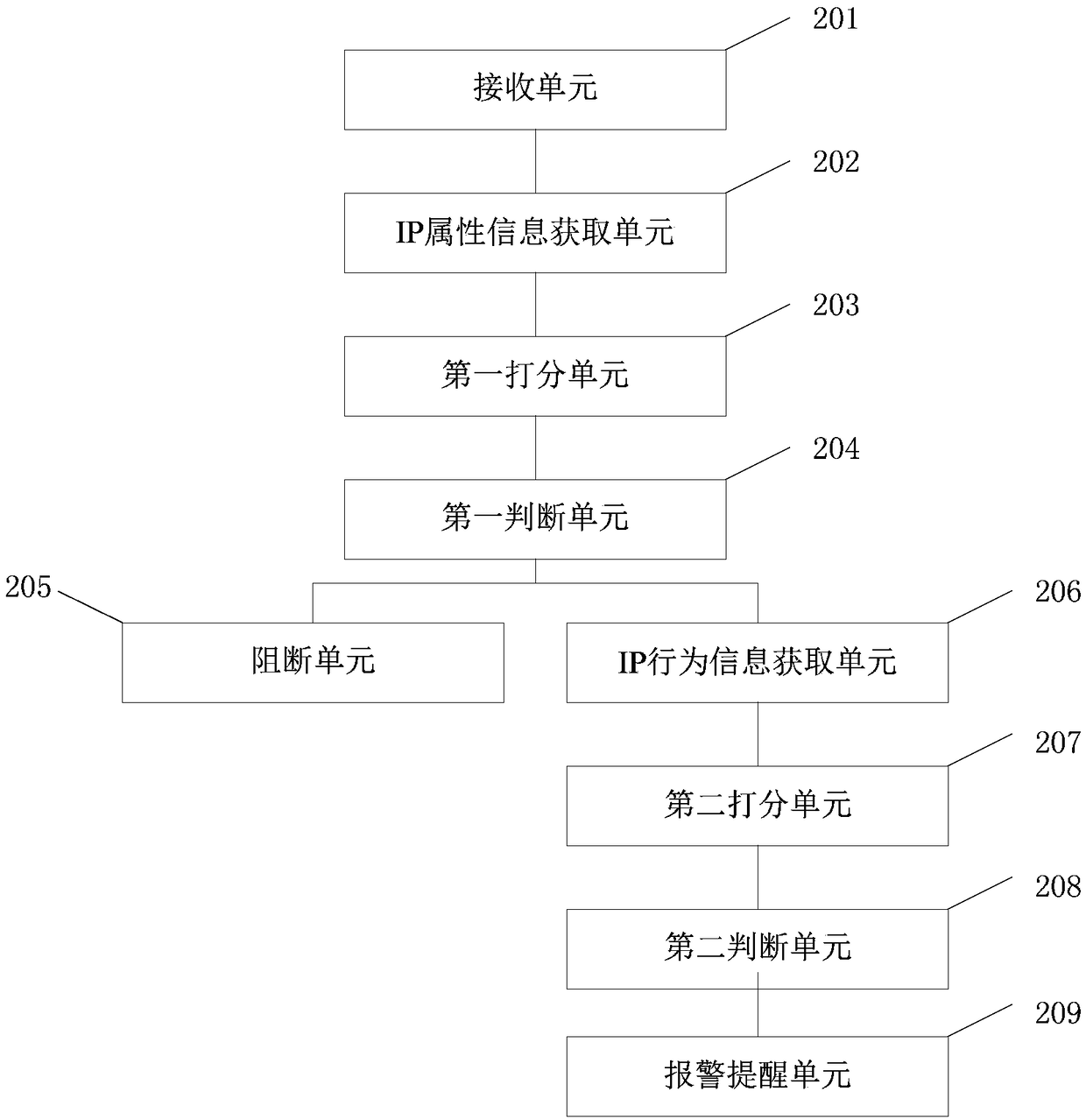

Processing method, device for network request, electronic device and storage medium

ActiveCN109510800AImprove blockageImprove the alarm effectTransmissionReal-time computingScoring rule

The embodiment of the invention provides a processing method, a device for network requests, an electronic device and a storage medium. The method comprises the following steps: obtaining IP attributeinformation corresponding to network requests; scoring the network requests for the first time according to a preset first scoring rule and the IP attribute information; determining whether the firstscoring score is lower than a preset first scoring threshold; if yes, blocking the network requests; if no, obtaining IP behavior information corresponding to the network requests; scoring the network requests for the second time according to a preset second scoring rule and the IP behavior information; determining whether the second scoring score is lower than a preset second score threshold; ifyes, sending an alert to the network requests. The embodiment of the invention blocks or alerts the network requests according to the IP attribute information and the IP behavior information corresponding to the network requests, thereby improving the blocking or alarming effect on the abnormal login / registration behavior of the network platform.

Owner:BEIJING KINGSOFT CLOUD NETWORK TECH CO LTD +1

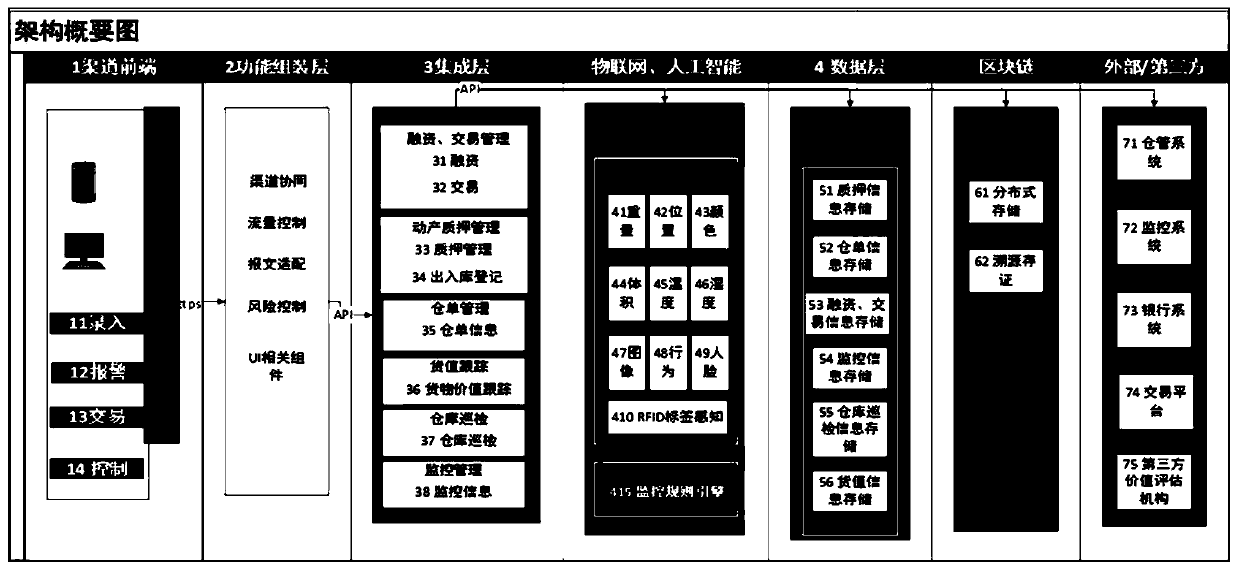

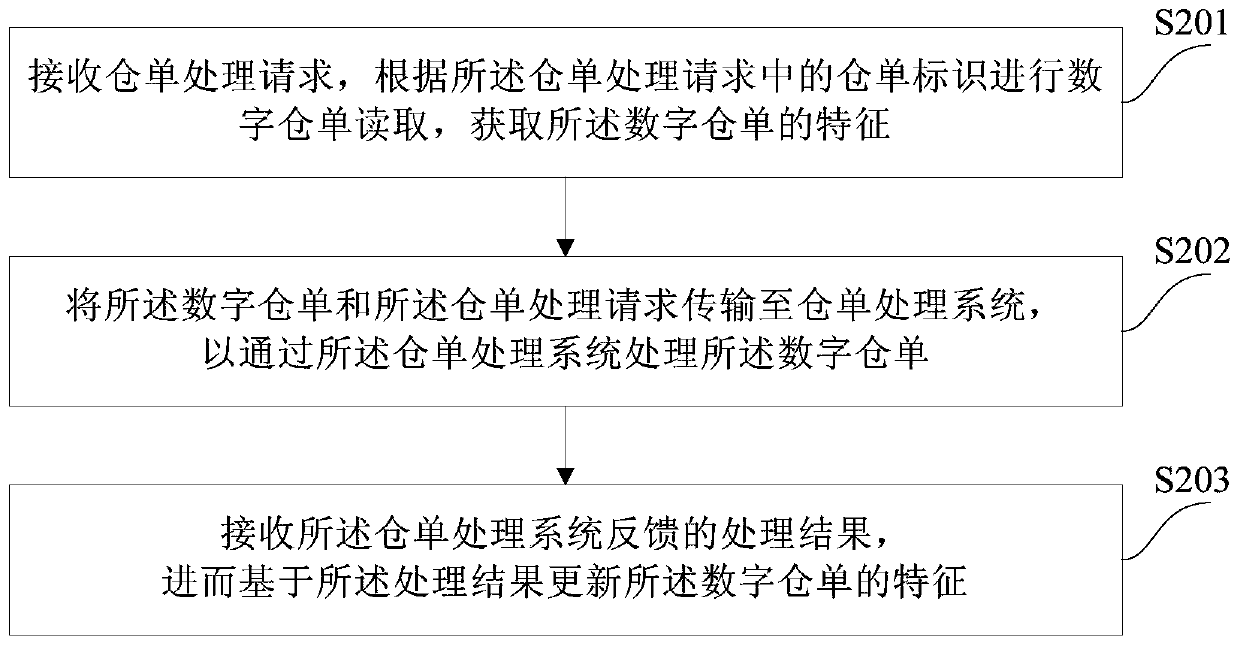

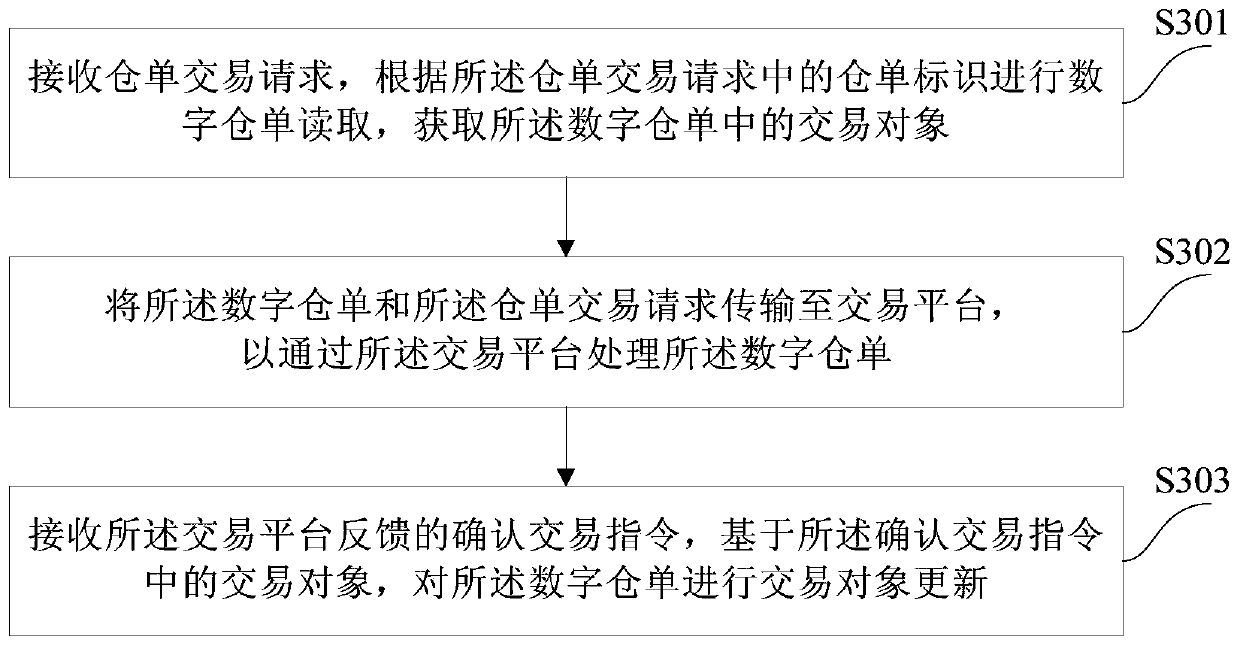

Digital warehouse receipt management method and device

PendingCN111429057AImprove risk control abilityMarket predictionsCo-operative working arrangementsHandling systemDatabase

The invention discloses a digital warehouse receipt management method and device, and relates to the technical field of computers. One specific embodiment of the method comprises the following steps:receiving a warehouse receipt processing request, and reading a digital warehouse receipt according to a warehouse receipt identifier in the warehouse receipt processing request to obtain characteristics of the digital warehouse receipt; transmitting the digital warehouse receipt and the warehouse receipt processing request to a warehouse receipt processing system so as to process the digital warehouse receipt through the warehouse receipt processing system; and receiving a processing result fed back by the warehouse receipt processing system, and updating the characteristics of the digital warehouse receipt based on the processing result. According to the implementation mode, the standardized digital warehouse receipt is provided, and the market value of articles in the digital warehousereceipt is dynamically tracked by ensuring the authenticity of the warehouse receipt, so that the risk control capability of the digital warehouse receipt in a movable property financing scene is improved, and the possibility of further innovation of the digital warehouse receipt in supply chain financial services is provided.

Owner:CCB FINTECH CO LTD

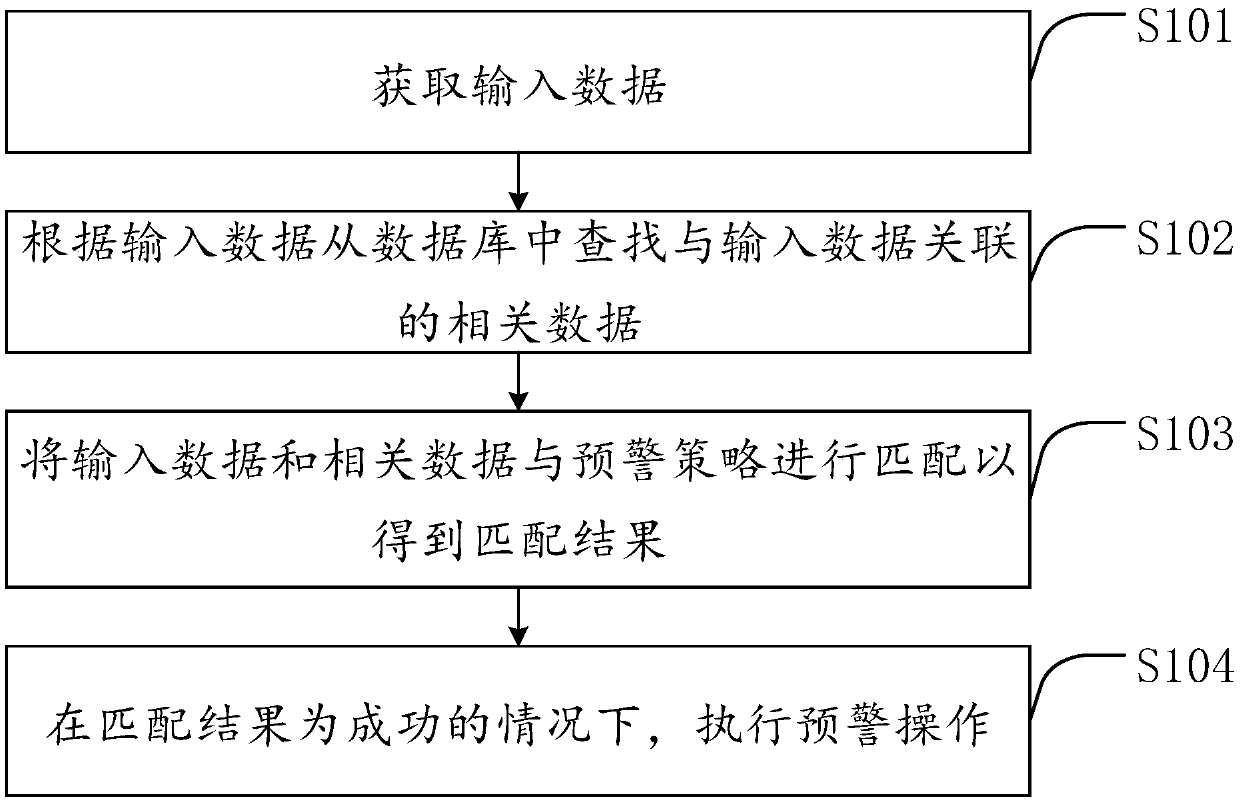

An anti-fraud early warning method and system

InactiveCN109522317ARealize identificationImprove risk control abilityDatabase queryingFinanceData miningComputer science

A method and system for anti-fraud early war is provided. The method comprises the following steps: obtaining input data; Searching relevant data associated with the input data from a database according to the input data, the relevant data having a corresponding relationship with an early warning strategy; Matching the input data and the related data with the alert strategy to obtain a matching result; If the matching result is successful, an alert operation is performed.

Owner:SHENZHEN BILLIONS FINANCE CO LTD

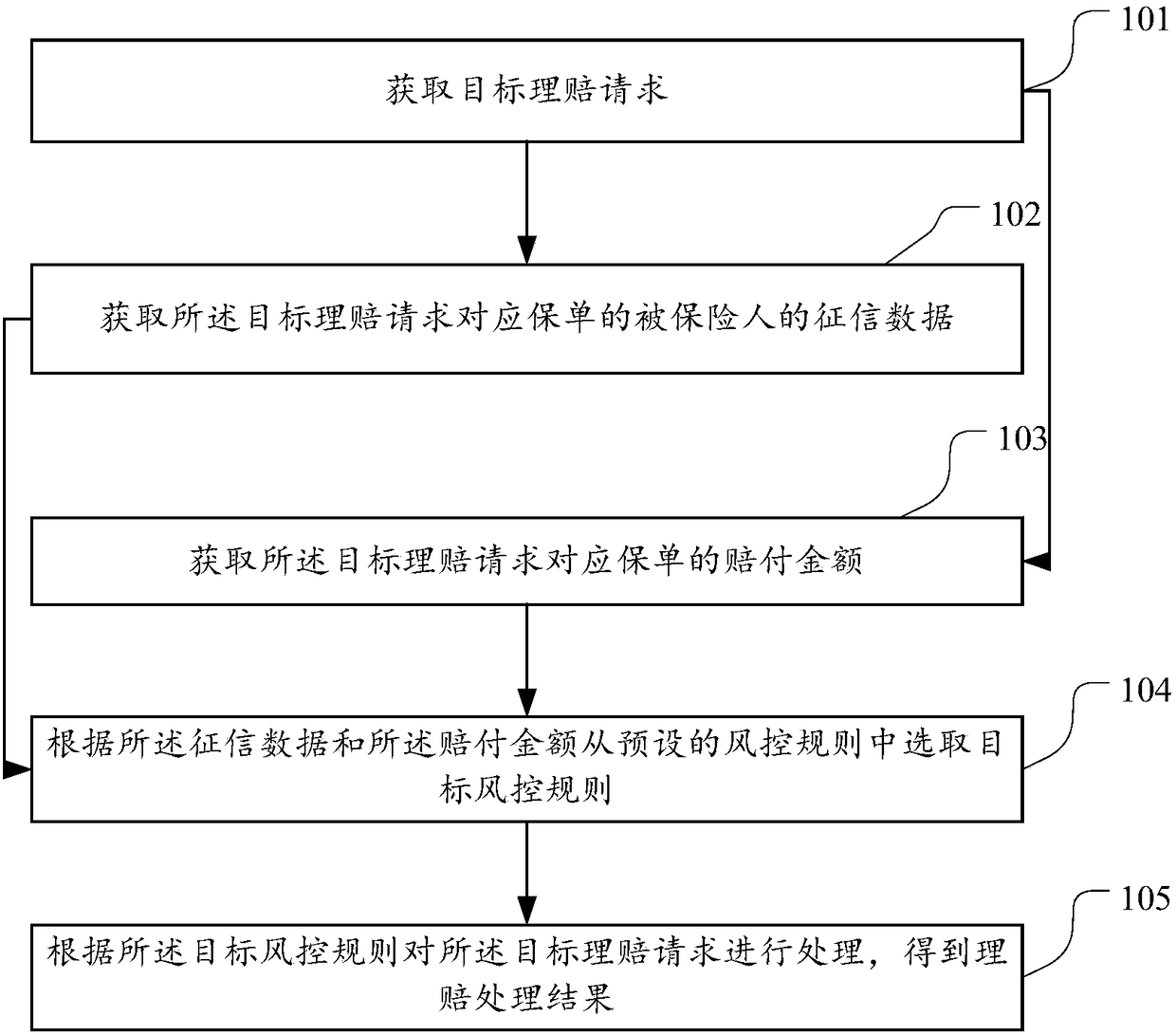

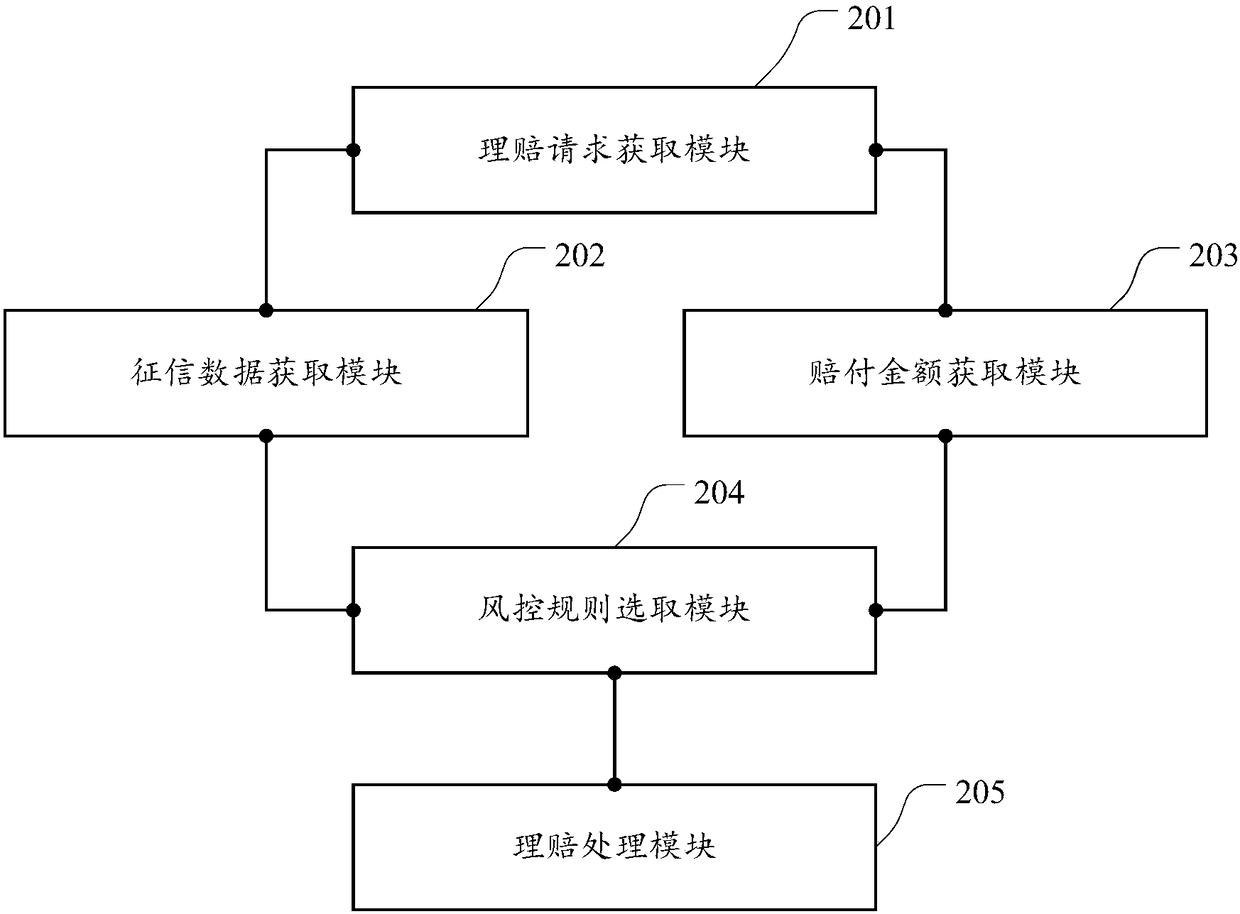

Method and device for processing claim settlement

The embodiment of the invention discloses a method for processing claim settlement, which is used for solving problems that the existing claim settlement risk control cannot be elaborated to every insurance policy and every insured and that the claim settlement risk control ability is insufficient. The method disclosed by the embodiment of the invention comprises the steps of obtaining a target claim settlement request; obtaining credit investigation data of the insured of an insurance policy corresponding to the target claim settlement request; obtaining the claim payment amount of the insurance policy corresponding to the target claim settlement request; selecting a target risk control rule from preset risk control rules according to the credit investigation data and the claim payment amount; and processing the target claim settlement request according to the target risk control rule to obtain a claim settlement processing result. The embodiment of the invention further provides a device for processing the claim settlement.

Owner:PING AN TECH (SHENZHEN) CO LTD

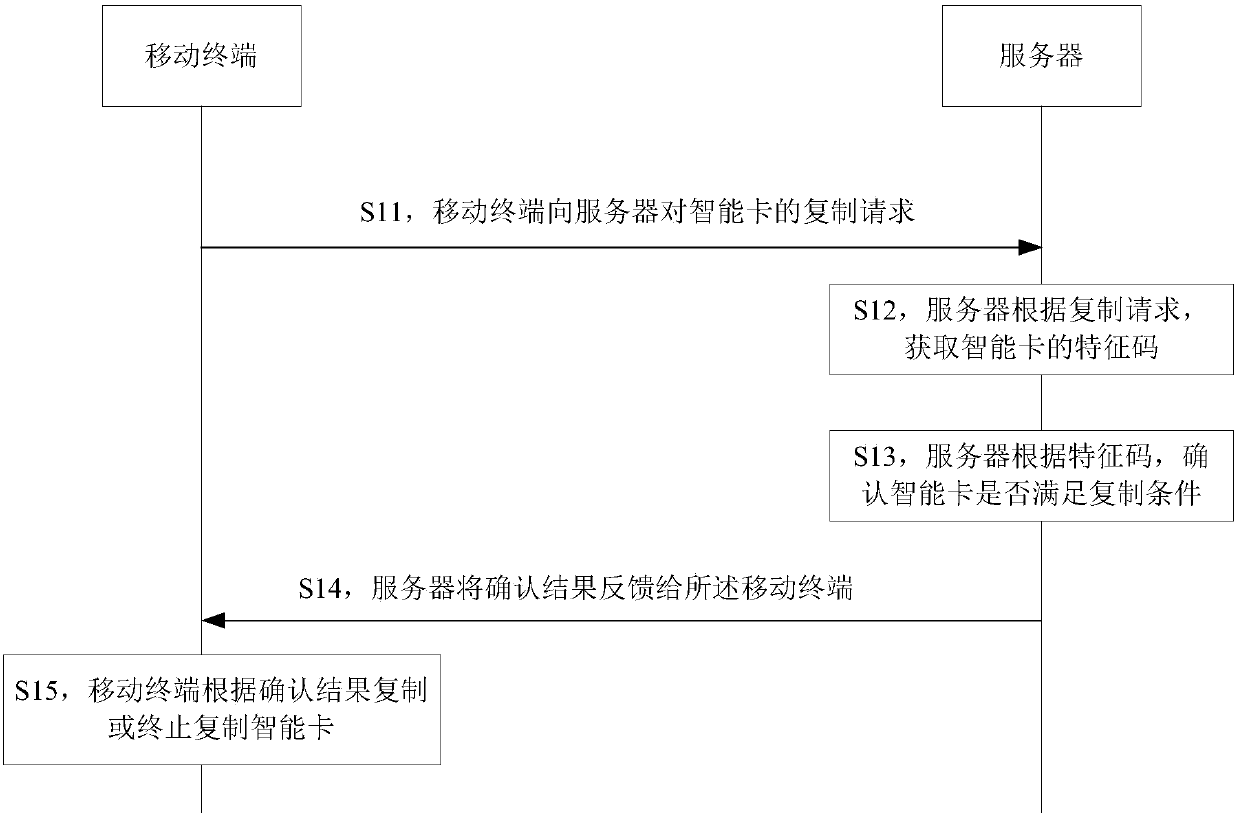

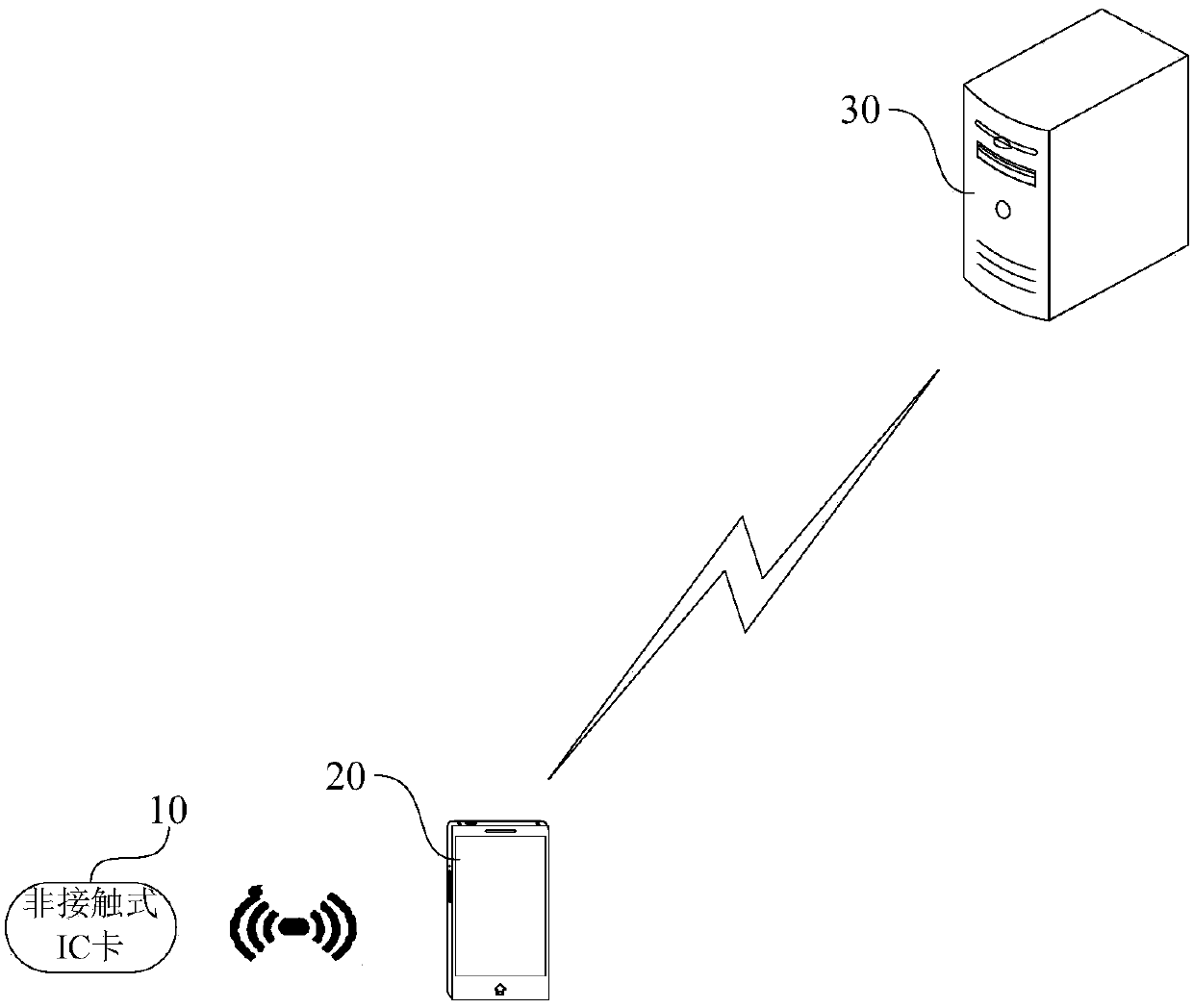

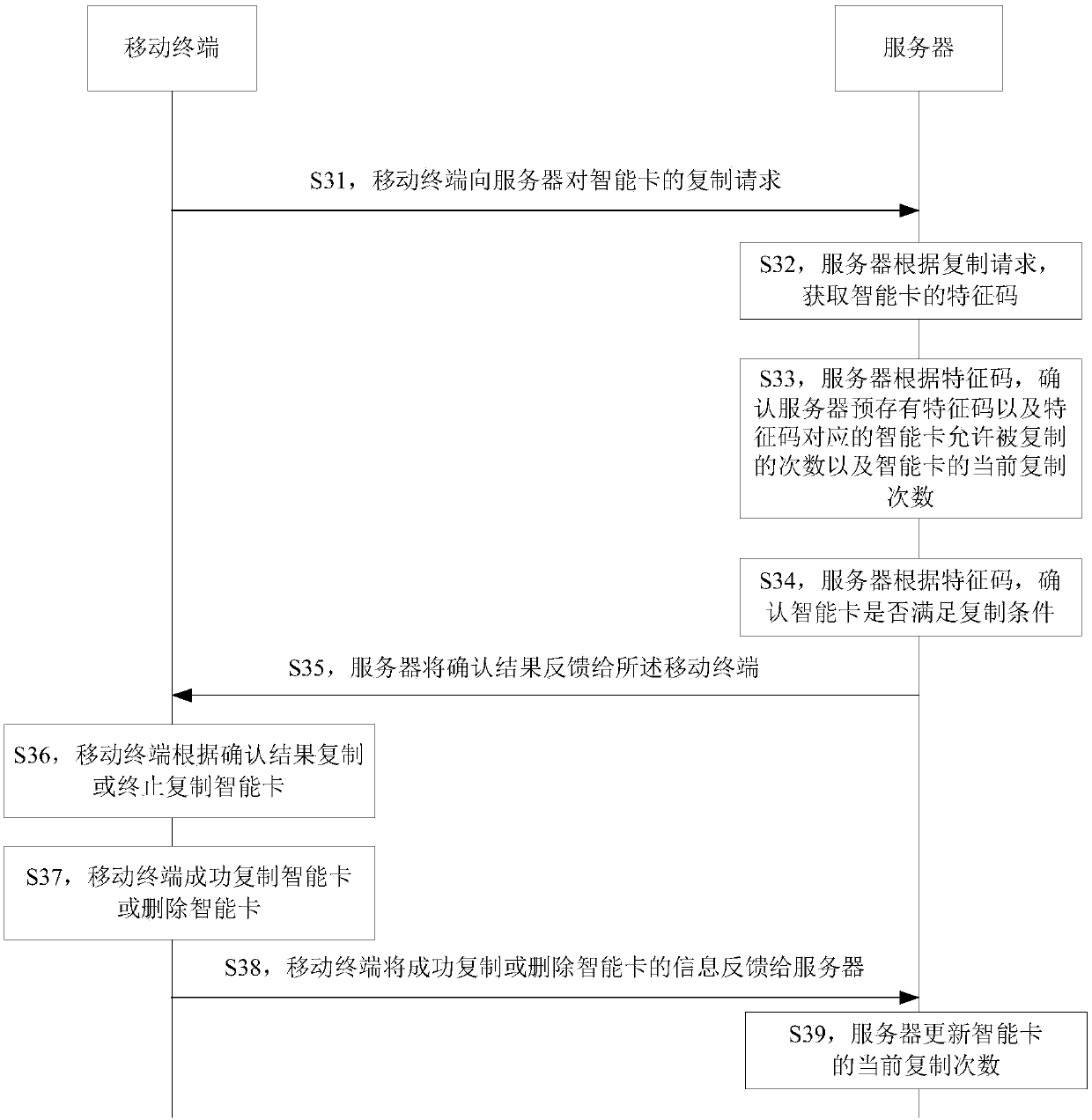

Method and device for copying intelligent card, and computer readable storage medium

ActiveCN108021967AAvoid abuseAvoid the situationRecord carriers used with machinesSmart cardFeature code

The present invention discloses a method and a device for copying an intelligent card, and a computer readable storage medium. The technical problem is solved that an intelligent card is easy to copyin the prior art. The method comprises the steps of: receiving a copy request, sent by a mobile terminal, for an intelligent card; according to the copy request, obtaining feature codes of the intelligent card, wherein the feature codes are obtained by employing an algorithm and calculating data of the intelligent card; according to the feature codes, confirming whether the intelligent card can meet a copy condition or not; and performing feedback of a confirmation result to the mobile terminal to allow the mobile terminal to copy or stop copy the intelligent card according to the confirmationresult.

Owner:BEIJING XIAOMI MOBILE SOFTWARE CO LTD

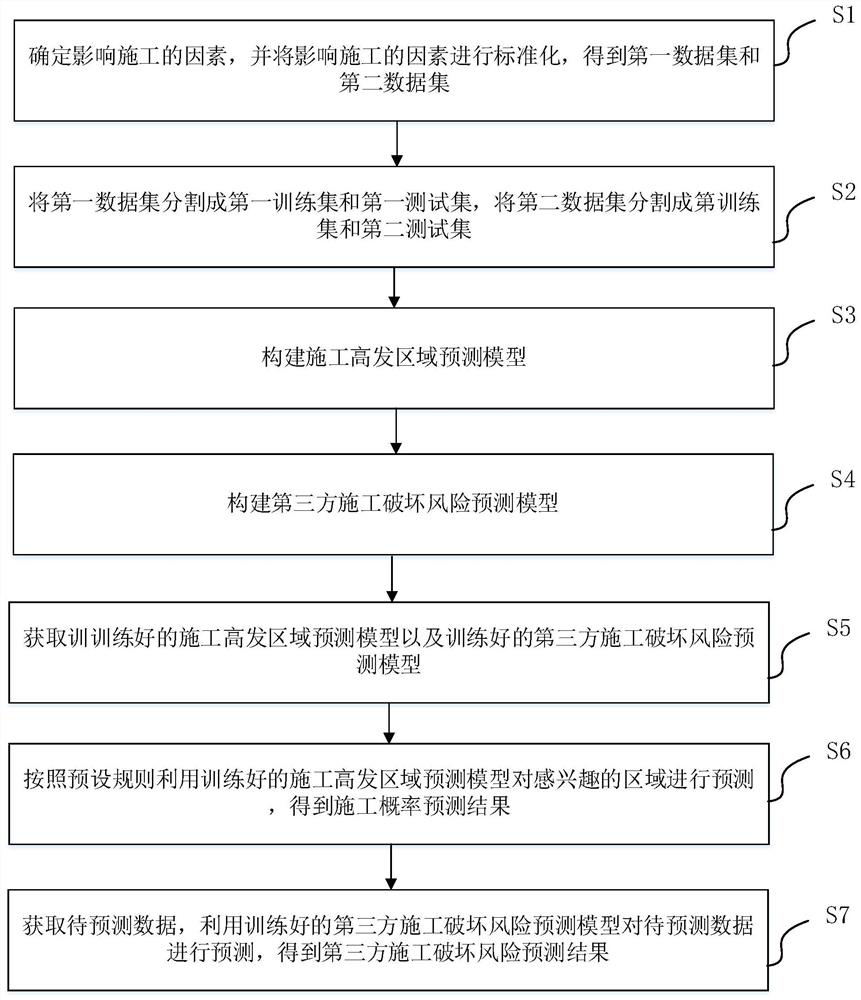

Early warning method and device for preventing third-party construction damage risk of gas pipe network

PendingCN111859779AImprove securityImprove economyDesign optimisation/simulationResourcesThird partyRisk Control

The invention provides an early warning method and device for preventing a third-party construction damage risk of a gas pipe network. The method includes using construction cooperation data and construction damage event sample data supplemented by certain external big data to perform multi-dimensional statistical analysis on the characteristic rule of third-party construction and the characteristic rule of construction damage; excavating and identifying key influence factors of construction damage, classifying and evaluating failure consequences of the construction damage, and researching therelevance between the key influence factors and the failure consequences, so that a third-party construction damage risk prediction model and a construction high-incidence area prediction model are constructed. Guided by model, in combination with the current gas pipeline management and operation system and related laws and regulations in China, internal and external risk prevention and emergencymeasure suggestions are put forward in a targeted mode, so that third-party construction damage of the gas pipeline is reduced, the accident occurrence probability is reduced, the safety and economyof operation of an existing pipeline are improved, the enterprise risk control capacity is improved, and the life and property safety of people is maintained.

Owner:BEIJING GAS GRP

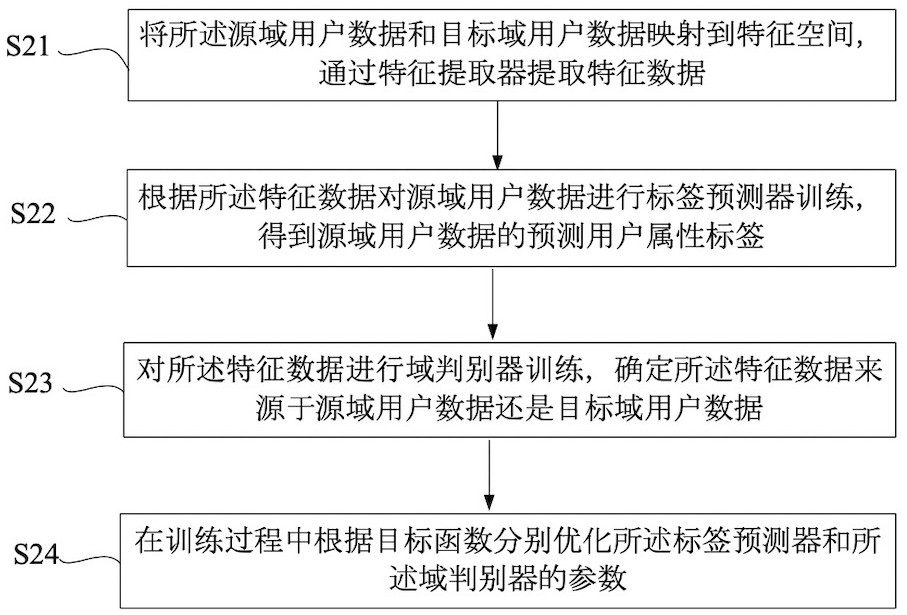

User identification method and device based on adversarial migration and electronic equipment

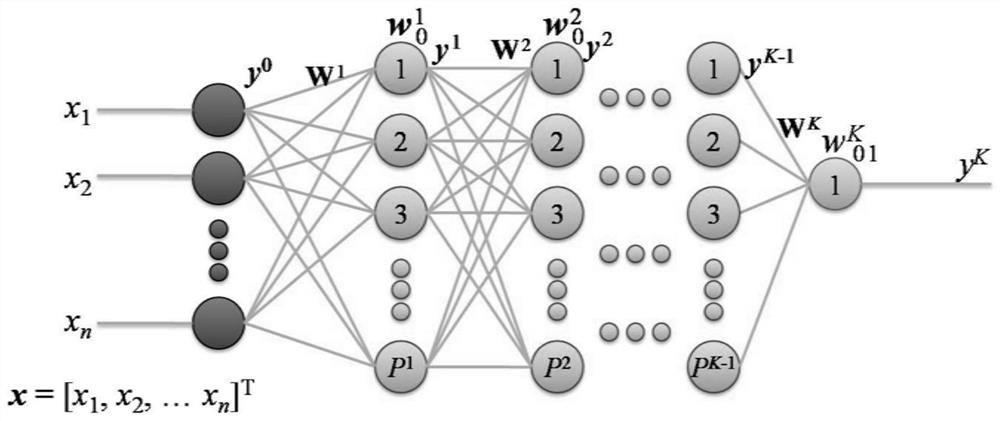

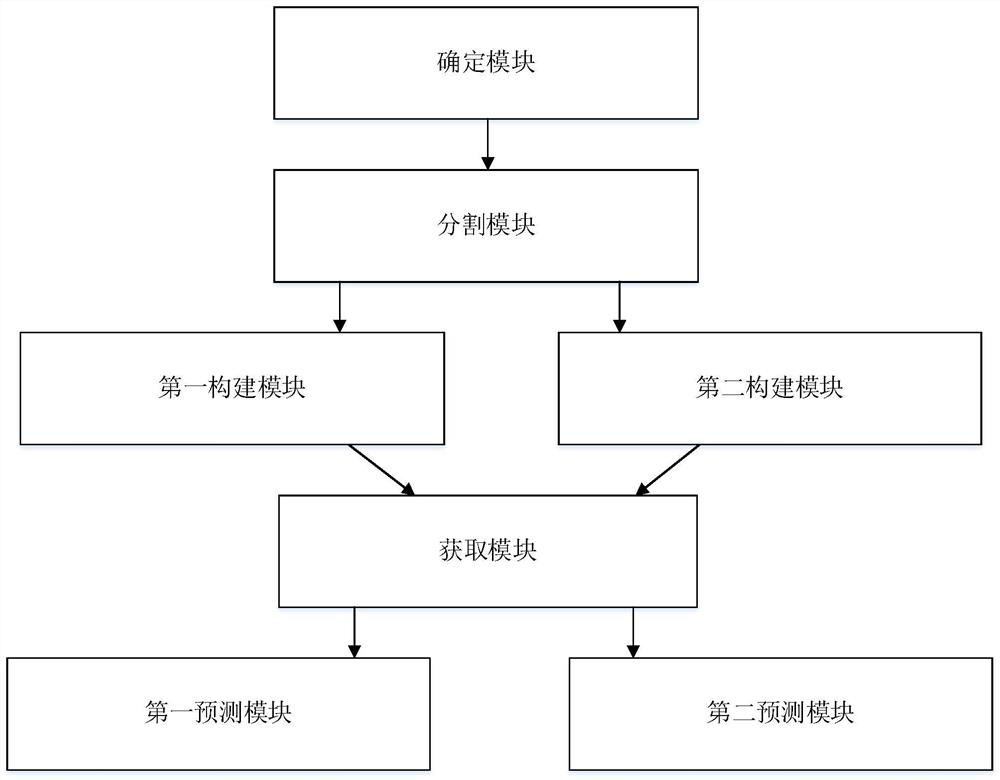

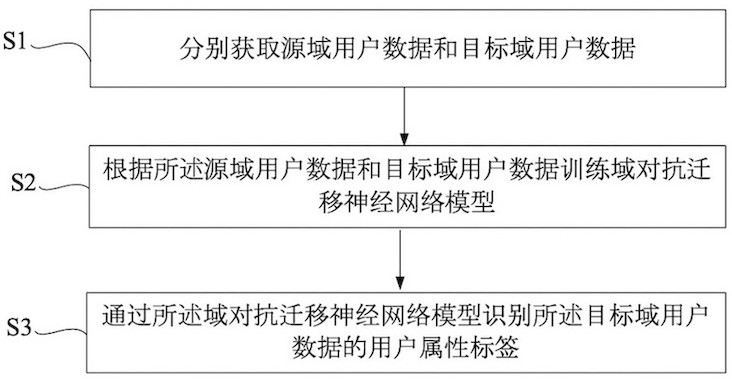

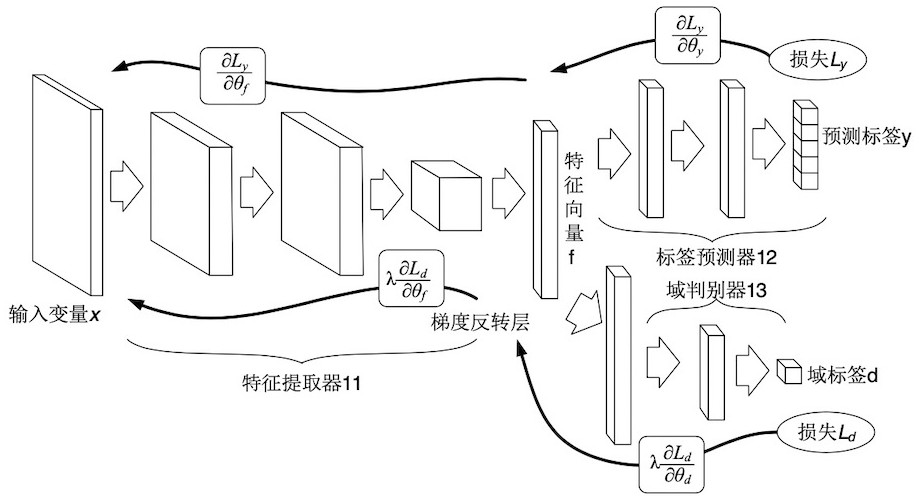

InactiveCN111626381AImprove classification accuracyImprove risk control abilityFinanceCharacter and pattern recognitionEngineeringNetwork model

The invention discloses a user identification method and device based on adversarial migration and electronic equipment. The method comprises the following steps: acquiring source domain user data andtarget domain user data; wherein the source domain user data comprises a user attribute label; training a domain adversarial migration neural network model according to the source domain user data and the target domain user data; and identifying a user attribute label of the target domain user data through the domain adversarial migration neural network model. By introducing the confrontation layer, features capable of being migrated among different domains are selected and extracted. A label predictor with good performance is trained in a source domain, a source domain and a target domain are distinguished through a domain classifier in the training process, parameters of the label predictor and the domain discriminator are optimized according to a target function, and a classifier withgood performance in the target domain is obtained.

Owner:北京淇瑀信息科技有限公司

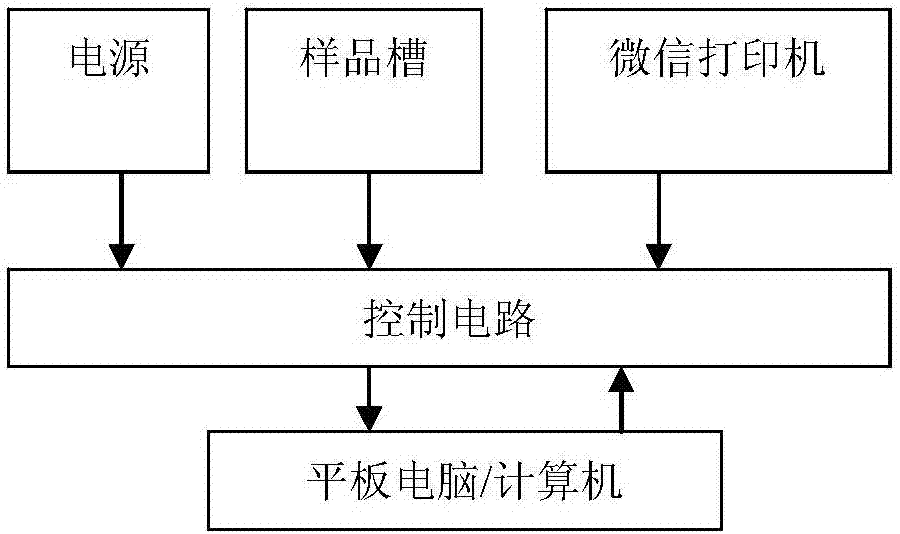

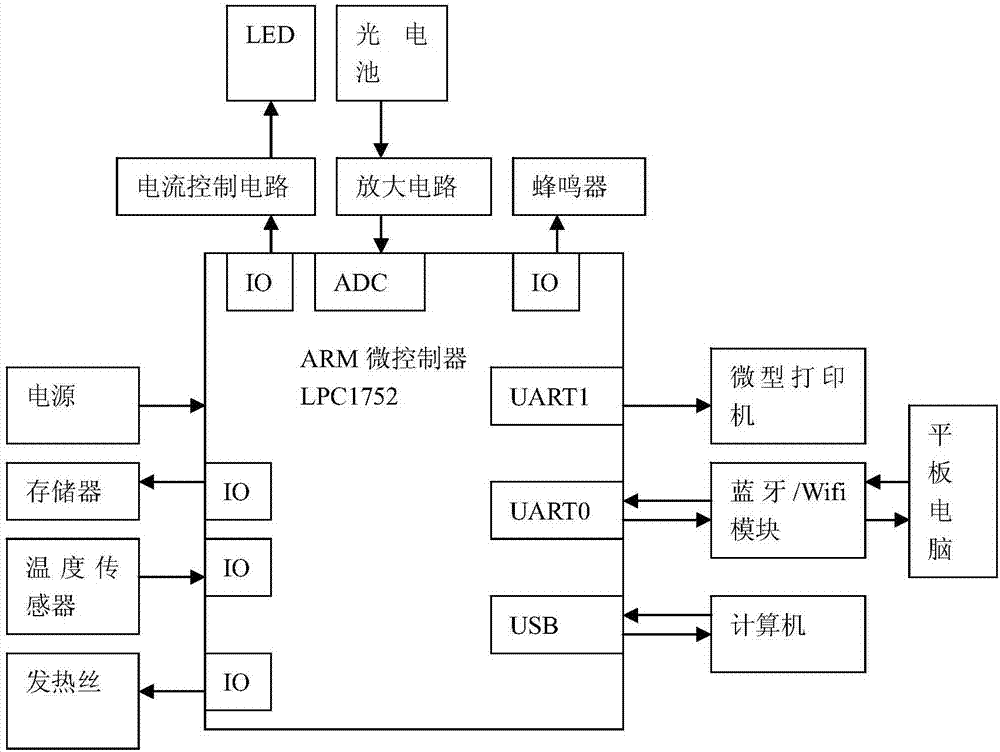

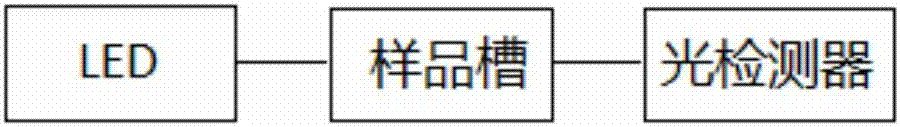

Method for evaluating detection quality of pesticide residue quick detection instrument

InactiveCN107202765AImprove risk control abilityImprove controlColor/spectral properties measurementsLinear correlationFood safety

The invention relates to the technical field of food safety, and discloses a method for evaluating detection quality of a pesticide residue quick detection instrument. The method comprises the following steps of obtaining standard reference data of different vegetable varieties in advance; when an operator detects a to-be-detected vegetable sample, comparing the measured initial absorbance value of the to-be-detected vegetable sample extracting liquid, the stable absorbance value after reaction for 10min by adding enzyme and a coloring agent, and the standard reference data of the vegetable variety; comparing the linear correlation coefficient Y3 of absorbance value and time of the to-be-detected sample extracting liquid and the preset value, and evaluating whether the operation of an operator is standard or not, so as to judge whether the obtained enzyme inhibiting rate value after detection is valid or not. The evaluation method has the advantages that the ability of base level detection controlling the pesticide residue risk is improved, and the management level of the pesticide residue detection is improved.

Owner:GUANGZHOU RUISEN BIOTECH

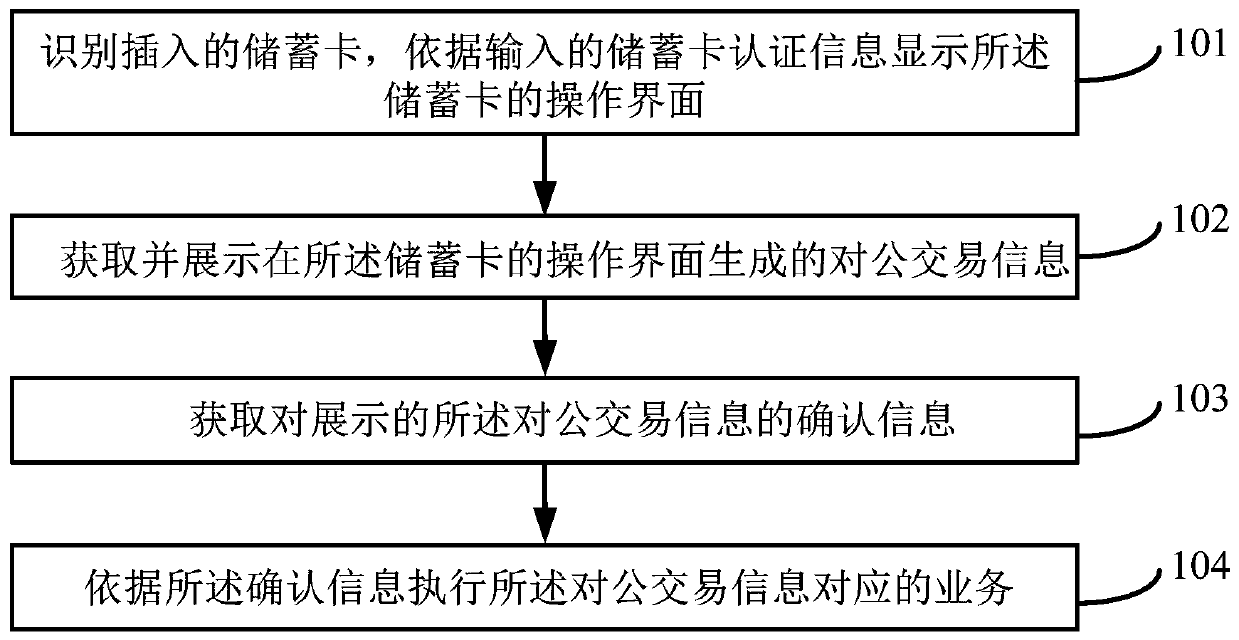

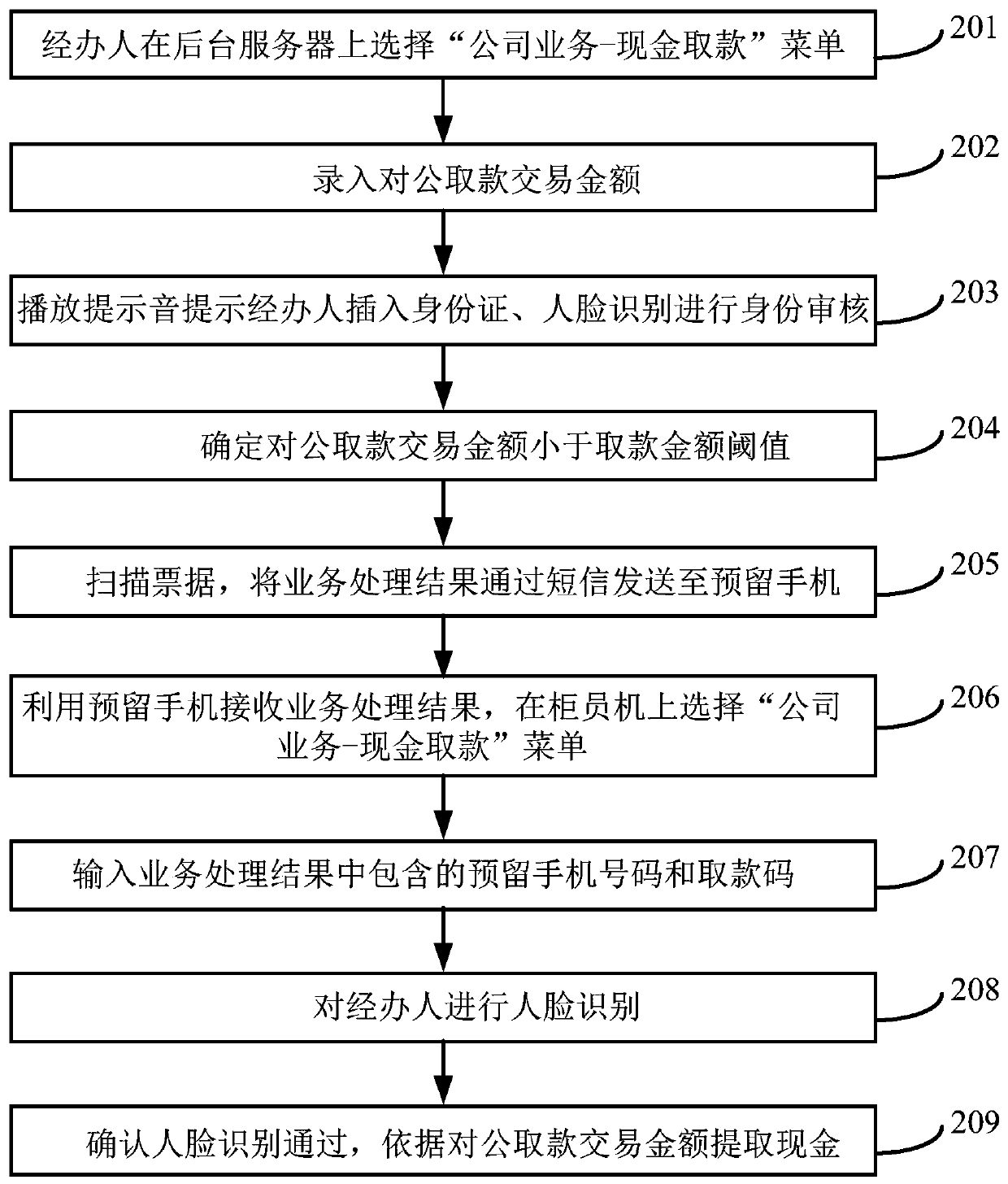

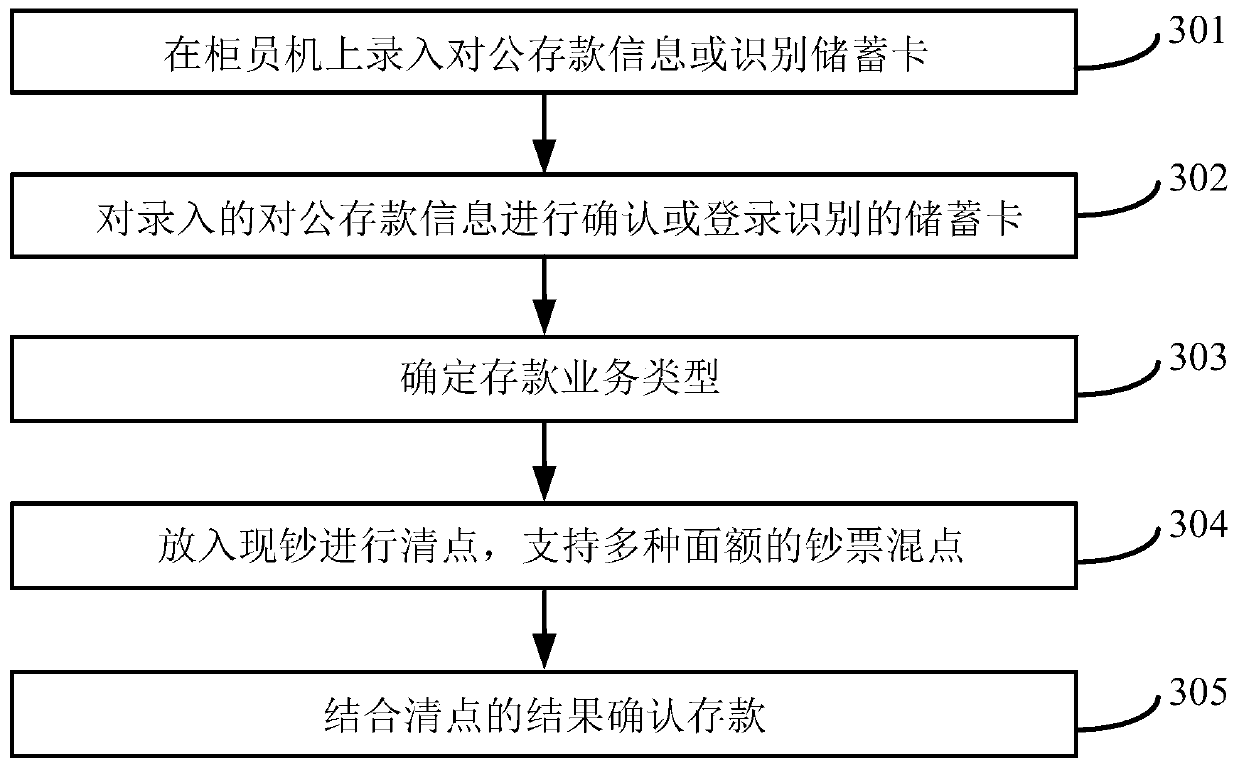

Corporation money depositing and withdrawing method and device

InactiveCN109887194ARelease resourcesReduce workloadComplete banking machinesFinanceService efficiencyOperating system

The application provides a corporation money depositing and withdrawing method and device. The corporation money depositing and withdrawing method comprises the following steps: identifying an inserted deposit card, and displaying an operation interface of the deposit card according to the input deposit card authentication information; acquiring and displaying the corporation transaction information generated at the operation interface of the deposit card; acquiring the confirming information for the displayed corporation transaction information; and executing the service corresponding to thecorporation transaction information according to the confirming information. The corporation service efficiency can be improved.

Owner:CHINA CONSTRUCTION BANK

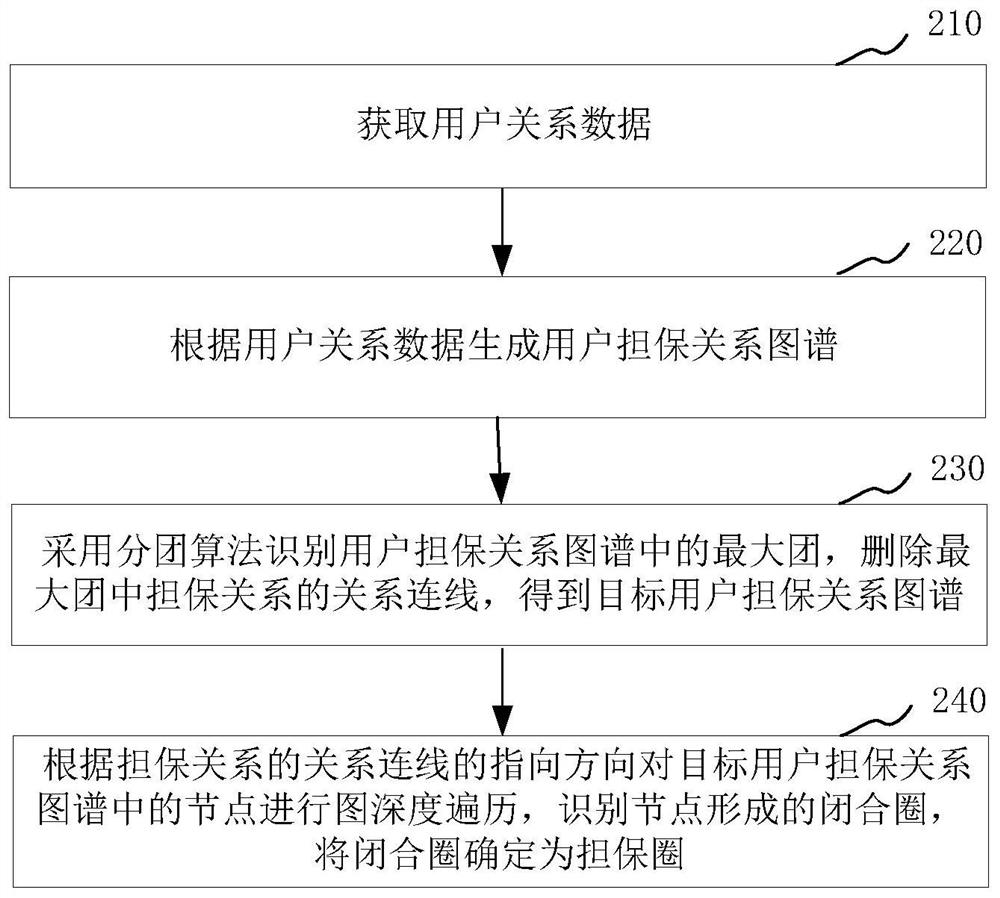

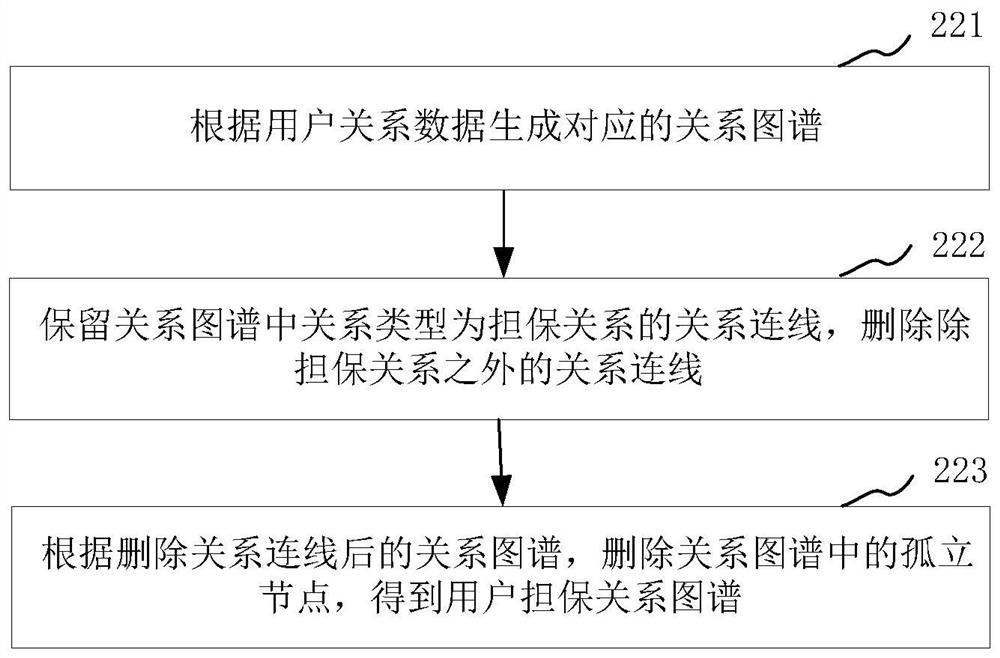

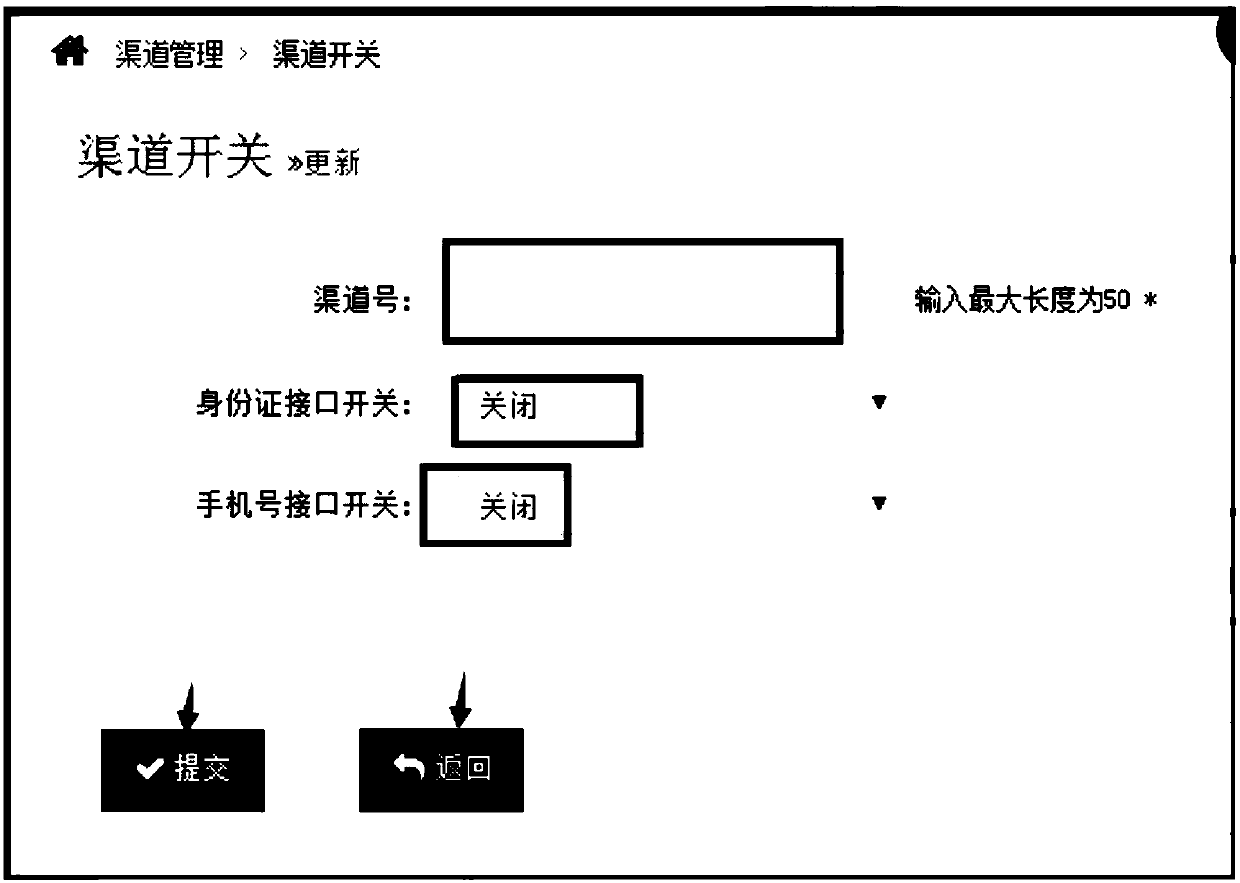

Guarantee circle recognition method and device, computer equipment and storage medium

ActiveCN111784495AImprove recognition efficiencyImprove risk control abilityFinanceSpecial data processing applicationsGraph spectraAlgorithm

The invention relates to a guarantee circle recognition method and device, computer equipment and a storage medium. The method comprises the steps of obtaining user relationship data; generating a user guarantee relationship graph according to the user relationship data; identifying the maximum group in the user guarantee relationship graph by adopting a grouping algorithm; and deleting the relationship connecting line of the guarantee relationship in the maximum group to obtain a target user guarantee relationship graph, further performing graph depth traversal on nodes in the target user guarantee relationship graph according to the pointing direction of the relationship connecting line of the guarantee relationship, identifying a closed loop formed by the nodes, and determining the closed loop as the guarantee loop. Compared with a manual auditing mode for identifying the guarantee circle, the method has the advantages that the recognition efficiency of the guarantee circle is greatly improved, risk points cannot be missed based on recognition of graph depth traversal, and then the risk control capability is improved.

Owner:JIANGSU CHANGSHU RURAL COMMERICAL BANK CO LTD

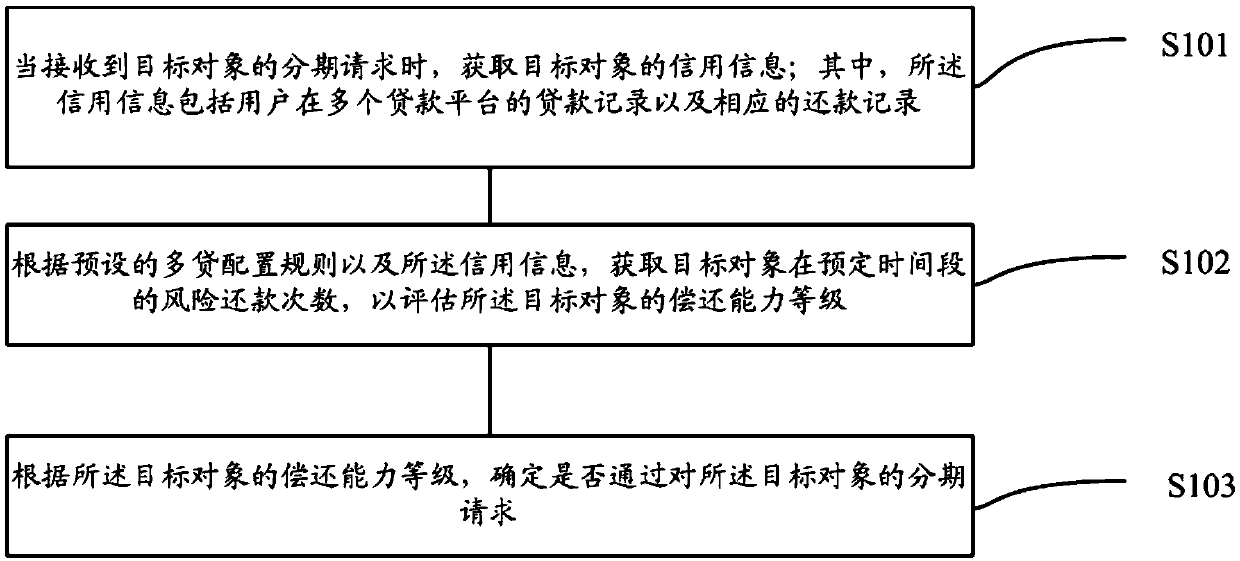

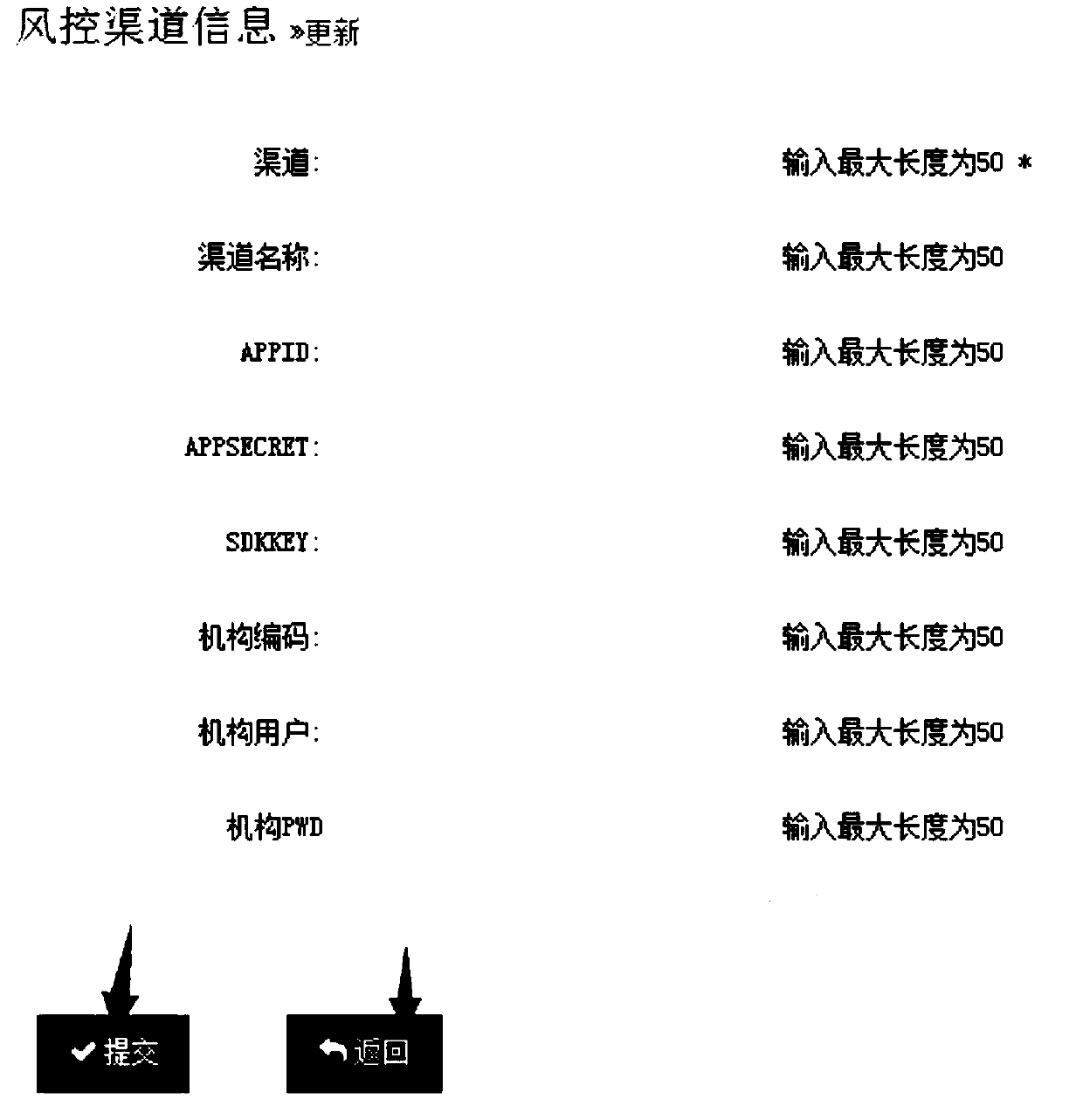

Multi-loan staging risk control management method and system

The invention discloses a multi-loan staging risk control management method and system, and the method comprises the steps: obtaining the credit information of a target object when receiving a stagingrequest of the target object; Wherein the credit information comprises loan records of the user on a plurality of loan platforms and corresponding repayment records; According to a preset multi-loanconfiguration rule and the credit information, obtaining the risk repayment frequency of a target object in a predetermined time period so as to evaluate the repayment capability level of the target object; And determining whether to pass a staging request for the target object according to the repayment capability level of the target object. The credit information of the target object on a plurality of platforms or institutions is acquired through the risk control channel, and the repayment capability level of the user is evaluated based on the preset multi-loan configuration rule, so that the risk control management capability is improved.

Owner:厦门市七星通联科技有限公司

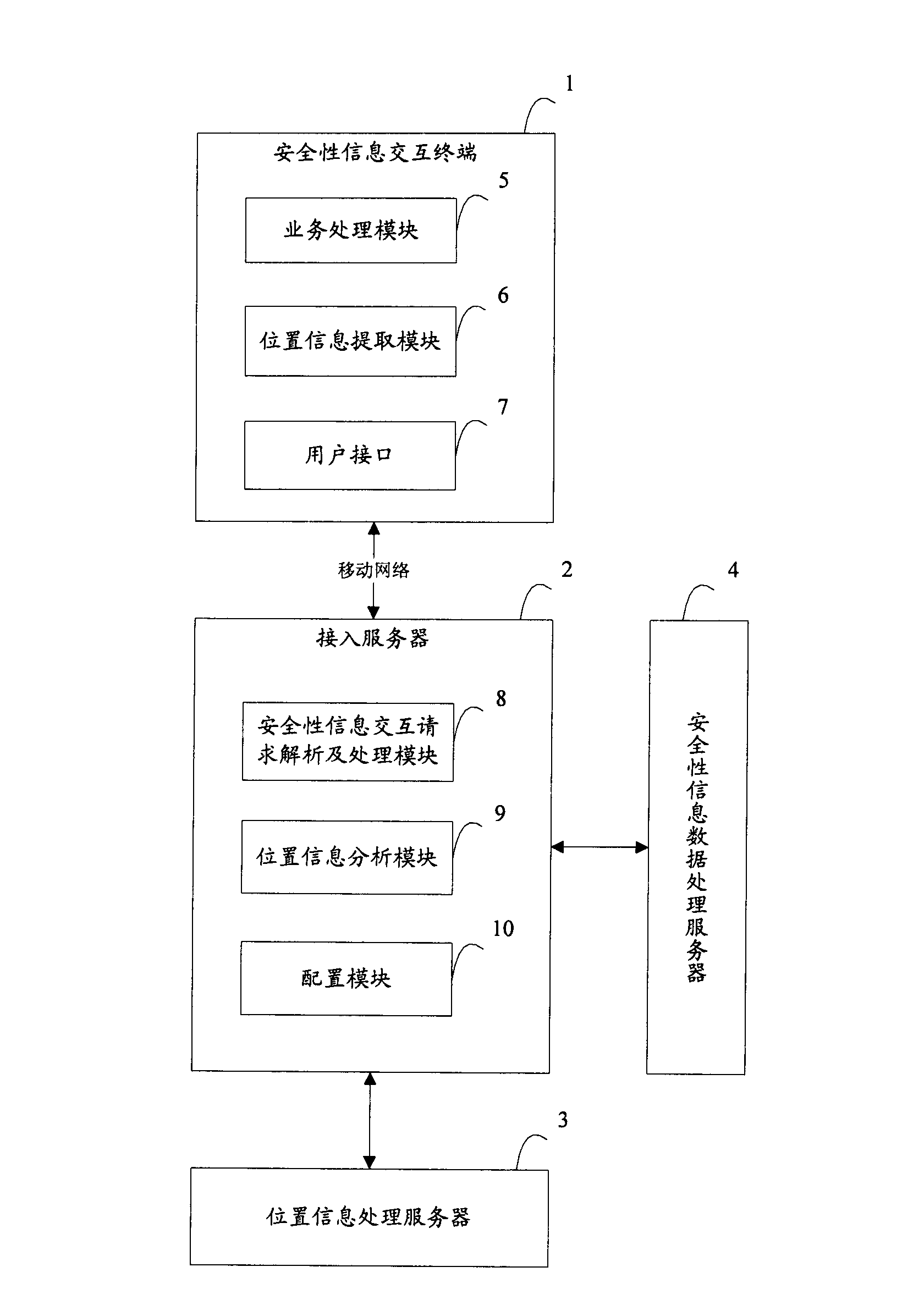

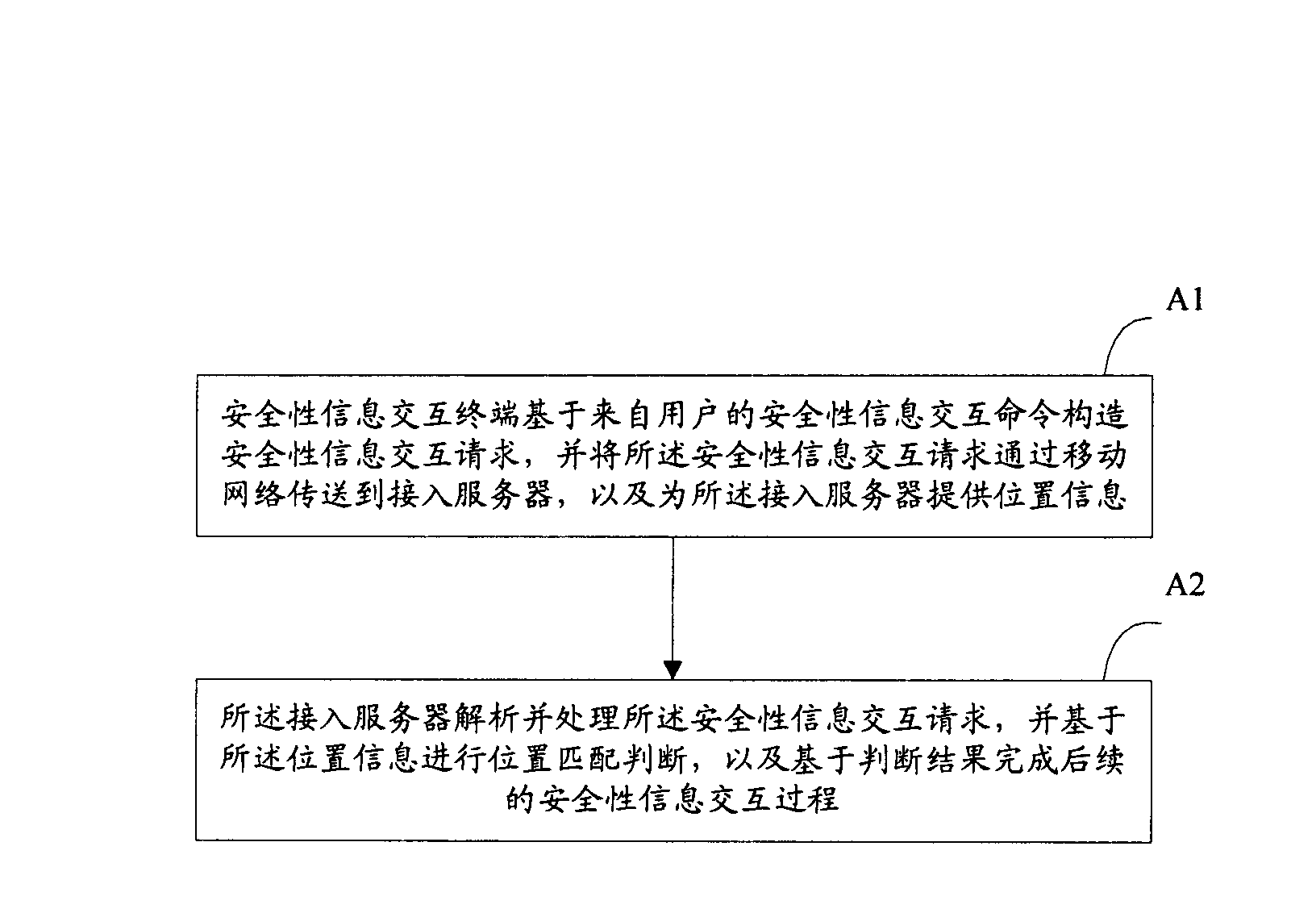

Terminal, server, system and method used for safety information interaction

ActiveCN103166925AGuaranteed free usePrevent illegal relocationTransmissionInteraction systemsRisk Control

The invention provides a system, a terminal, a server and a method used for safety information interaction and based on position parameters. The system for the safety information interaction comprises a safety information interaction terminal, an access server and a safety information data processing server, wherein the access server can conduct position matching judgment based on position information of the safety information interaction terminal and can complete a later safety information interaction process based on judging results. The system, the terminal, the server and the method used for the safety information interaction and based on the position parameters have high safety and reliability, and improve risk control capacity of the safety information interaction system.

Owner:CHINA UNIONPAY

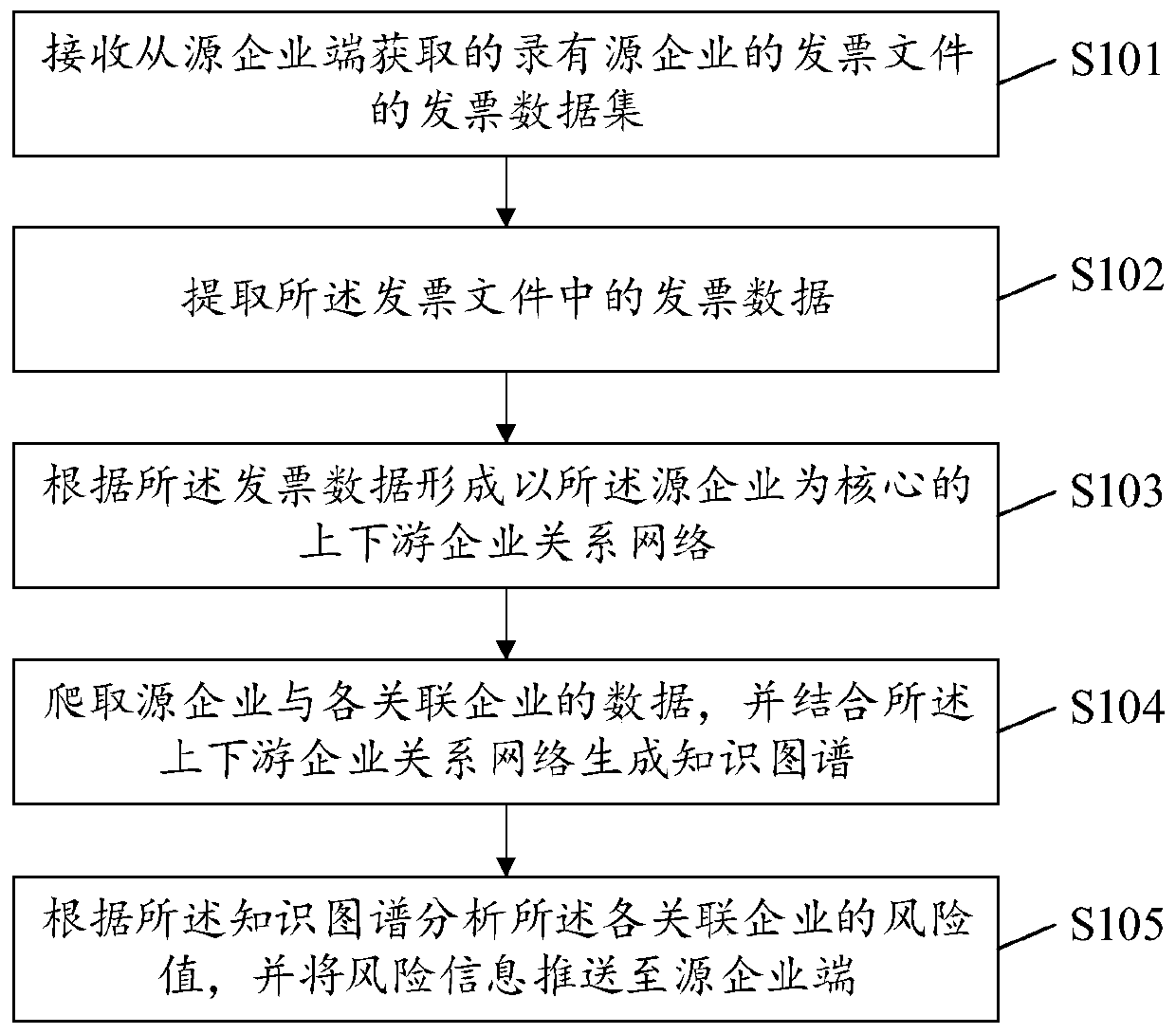

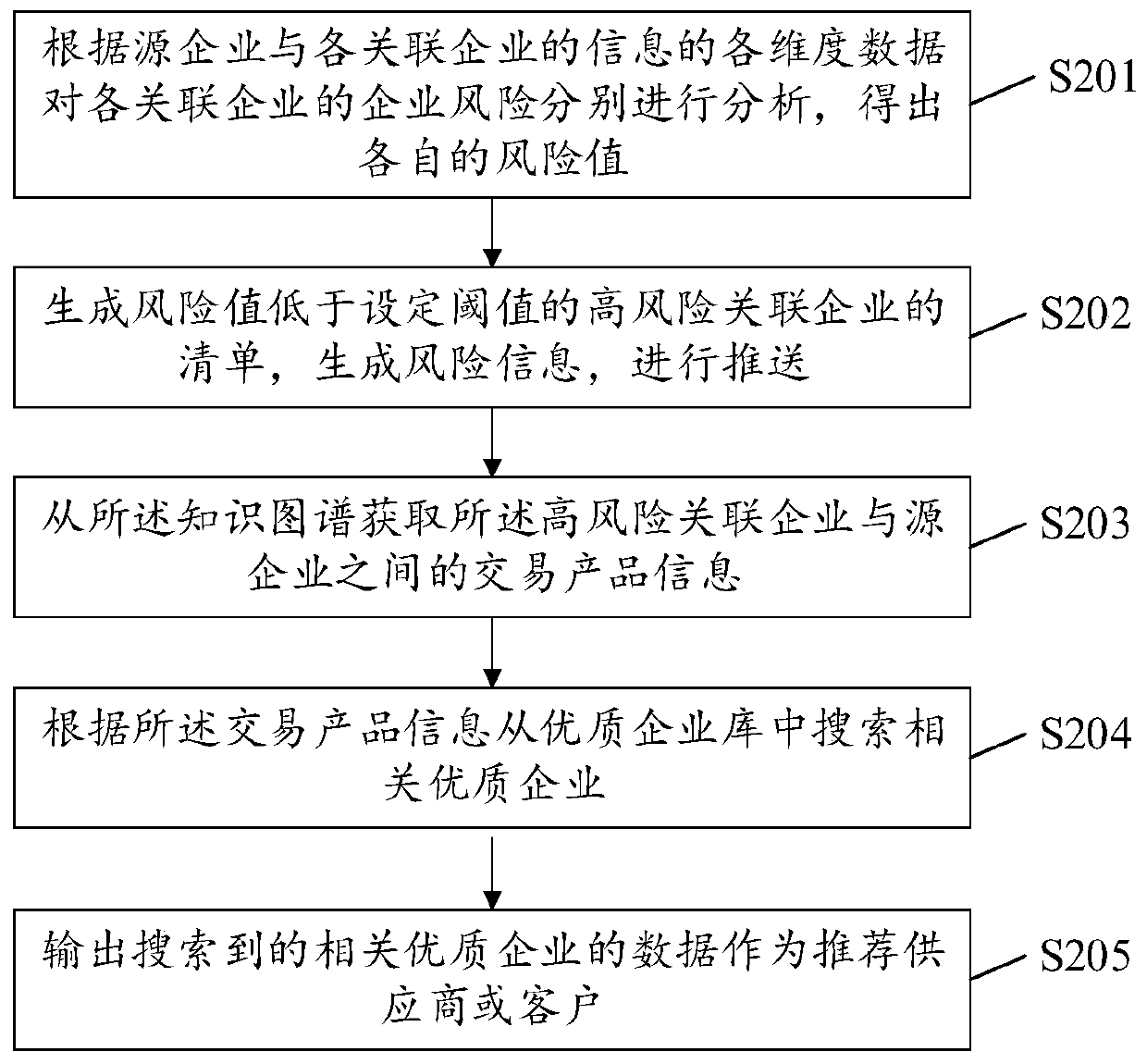

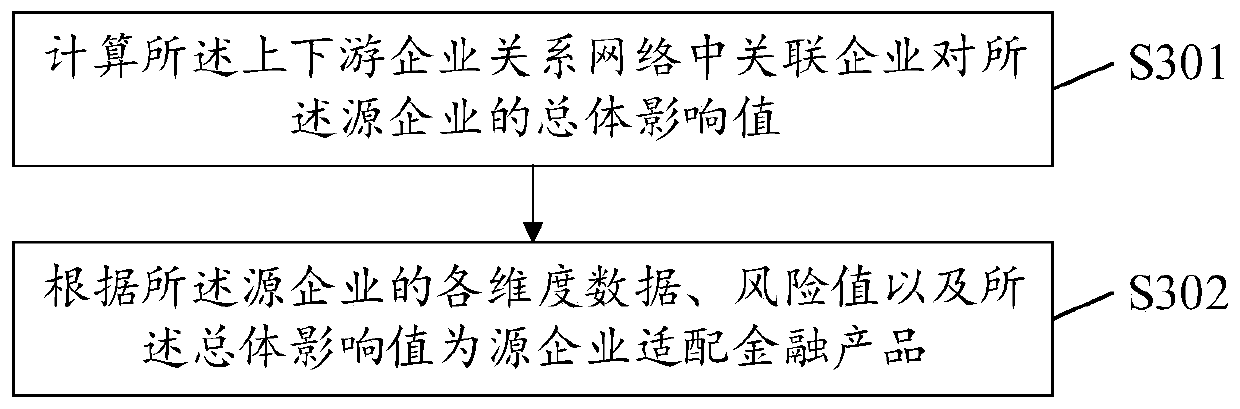

Invoice information mining method and device, computer equipment and storage medium

PendingCN111241161AImprove risk control abilityFinanceRelational databasesData setInformation mining

The invention discloses an invoice information mining method and device, computer equipment and a storage medium. The method comprises the steps of receiving an invoice data set which is obtained froma source enterprise terminal and records an invoice file of a source enterprise; extracting invoice data in the invoice file; forming an upstream and downstream enterprise relationship network takingthe source enterprise as a core according to the invoice data, wherein the upstream and downstream enterprise relationship network comprises the source enterprise and a plurality of associated enterprises; crawling data of the source enterprise and each associated enterprise, and generating a knowledge graph in combination with the upstream and downstream enterprise relationship network; and analyzing the risk value of each associated enterprise according to the knowledge graph, and pushing the risk information to a source enterprise terminal. According to the invoice information mining method and device, the computer equipment and the storage medium, the knowledge graph with the source enterprise as the core is constructed through the invoice data and the big data, data mining can be conducted through the knowledge graph, the risk control capacity is enhanced, and reference is provided for the decision making of banks and the source enterprise.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

Matrix Quantitative Analysis Method and System in Intelligent Trading

ActiveCN102866984BVerify validityKeep Profitable SecretsFinanceComplex mathematical operationsMatrix methodAnalysis method

Owner:BEIJING GZT NETWORK TECH

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com