Internet financial enterprise credit risk analysis method and system based on big data

A risk analysis and Internet technology, applied in the field of credit risk analysis of Internet financial enterprises based on big data, can solve the problems of few business entities covered, confusion of credit scoring standards, and high labor cost of credit investigation, so as to improve risk control ability and reduce Risk of going wrong, results backed by solid data

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

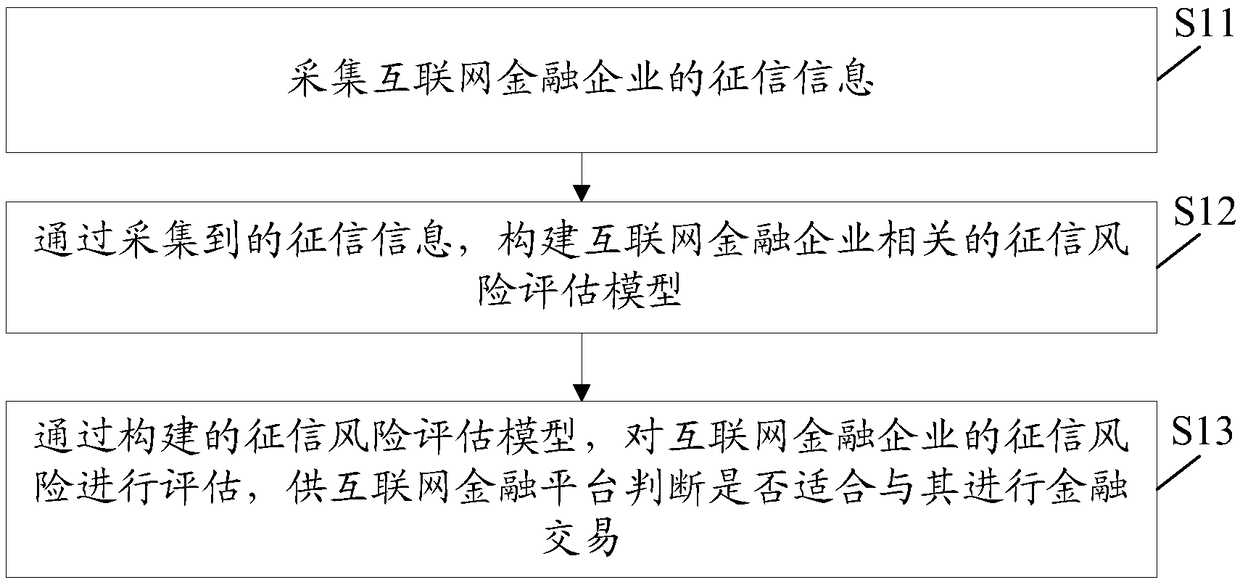

[0028] The embodiment of the present invention provides a method for analyzing the credit risk of Internet financial enterprises based on big data, which is suitable for Internet financial platforms to evaluate the credit risk of Internet financial enterprises, see figure 1 , the method can include:

[0029] Step S11, collect the credit information of Internet financial enterprises, the credit information includes: enterprise basic information, administrative penalty information, administrative license information, public opinion information, talent information, capital operation information, bidding information, legal proceedings information, intellectual property information , abnormal business information, and corporate annual report information.

[0030] In this embodiment, Internet financial enterprises refer to enterprises that participate in financial activities (such as credit, etc.) of Internet financial platforms. The credit investigation of these enterprises needs t...

Embodiment 2

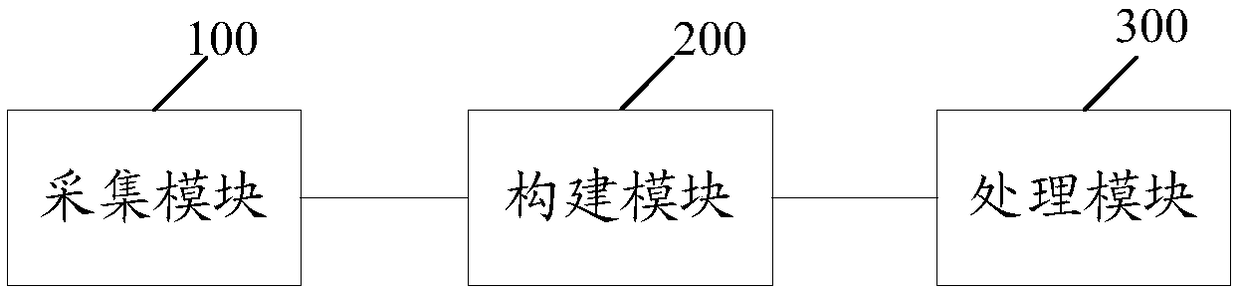

[0060] The embodiment of the present invention provides a big data-based Internet financial enterprise credit risk analysis system, which implements the method described in Embodiment 1, see figure 2 , the system may include: a collection module 100, a construction module 200, and a processing module 300.

[0061] The collection module 100 is used to collect credit information of Internet financial enterprises. The credit information includes: basic information of the enterprise, administrative penalty information, administrative license information, public opinion information, talent information, capital operation information, bidding information, legal proceedings information, At least one of intellectual property information, business abnormality information, and corporate annual report information.

[0062] In this embodiment, Internet financial enterprises refer to enterprises that participate in financial activities (such as credit, etc.) of Internet financial platforms...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com