Patents

Literature

41 results about "Credit analysis" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Credit analysis is the method by which one calculates the creditworthiness of a business or organization. In other words, It is the evaluation of the ability of a company to honor its financial obligations. The audited financial statements of a large company might be analyzed when it issues or has issued bonds. Or, a bank may analyze the financial statements of a small business before making or renewing a commercial loan. The term refers to either case, whether the business is large or small.

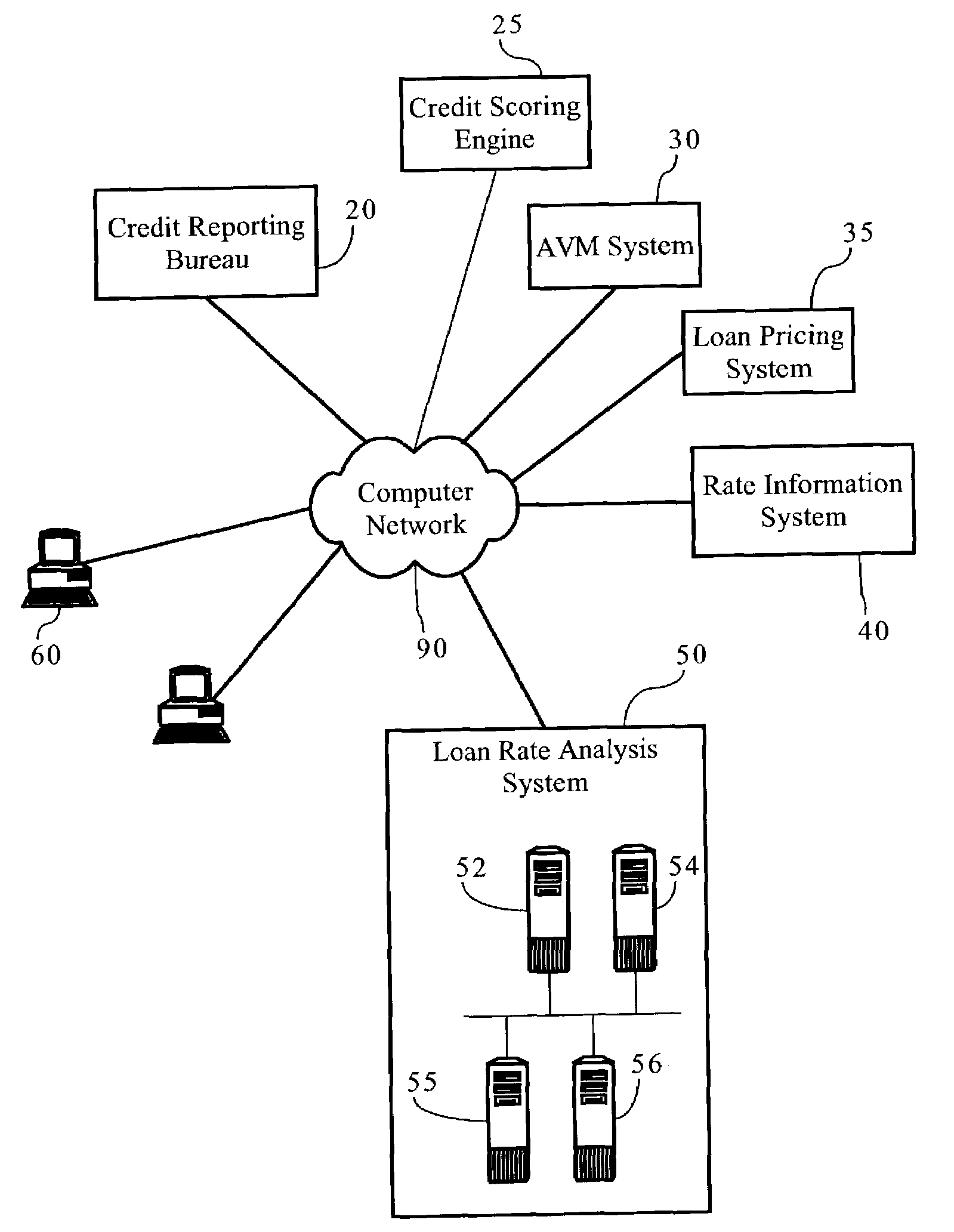

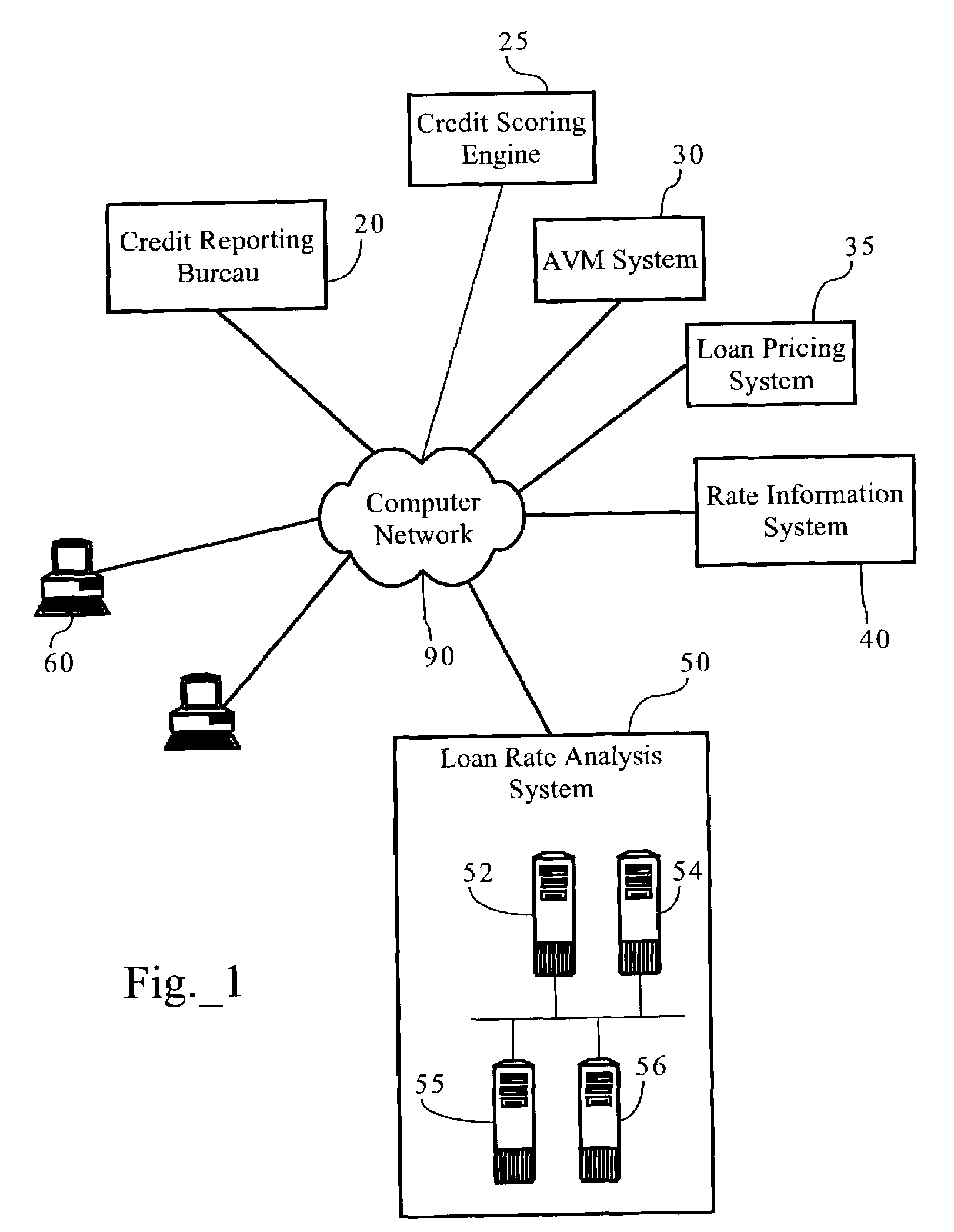

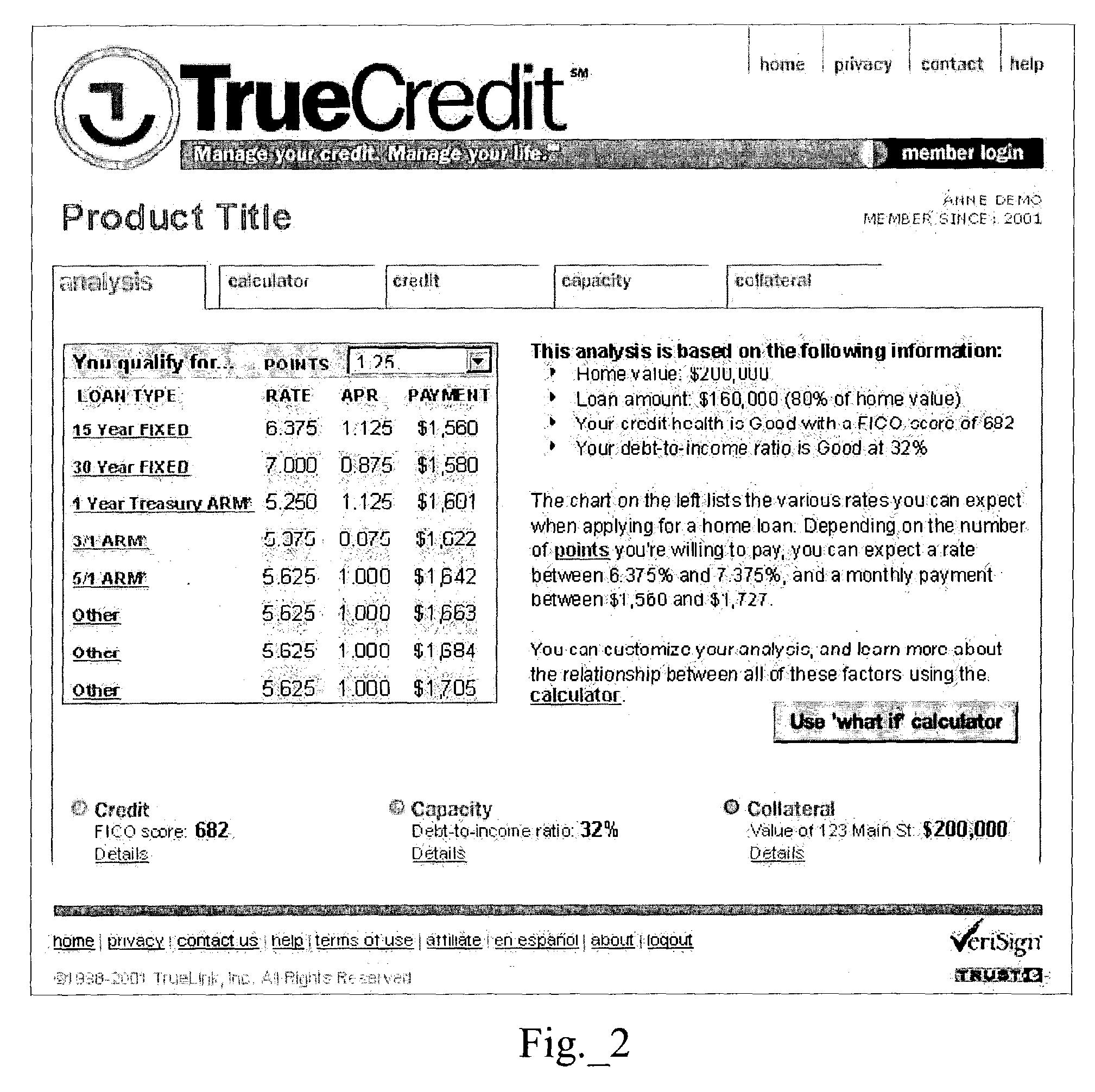

Loan rate and lending information analysis system

Methods, apparatuses and systems facilitating analysis of expected interest rates and, in some embodiments, other conditions and circumstances associated with a variety of different loan types. In one embodiment, the present invention allows for a network-based application allowing users the ability to assess for what loan interest rates they are eligible based on current interest rate data and credit analysis scores that are used to determine qualifications for one of a variety of interest rates. In one embodiment, the present invention enables a web-based loan rate analysis system that combines credit score analysis with analyses of collateral and debt / income to offer users the ability to learn for what loan interest rates they are eligible when purchasing or refinancing a home. Embodiments of the present invention further provide “what if” calculators allowing users to assess the impact of hypothetical changes to various factors determinative of available loan rates and other circumstances associated with loans.

Owner:TRANSUNION INTERACTIVE

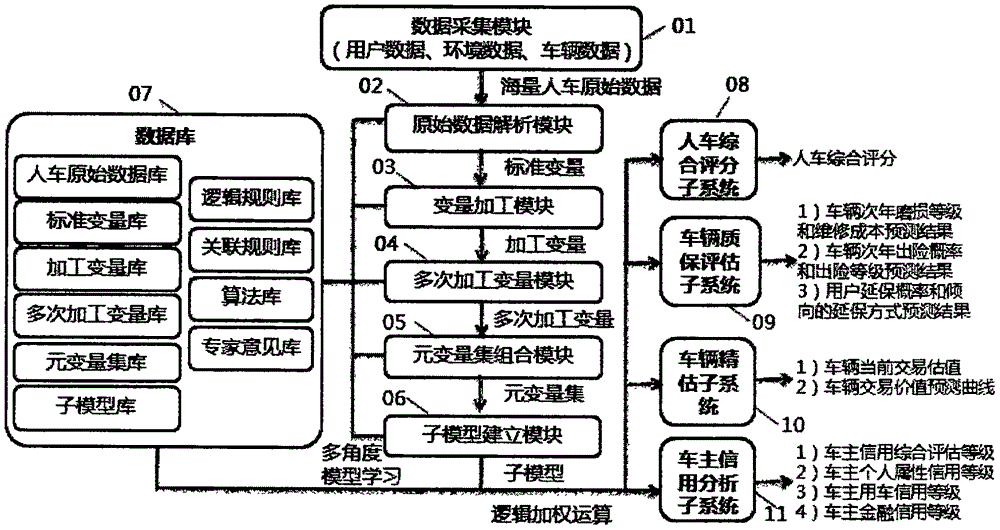

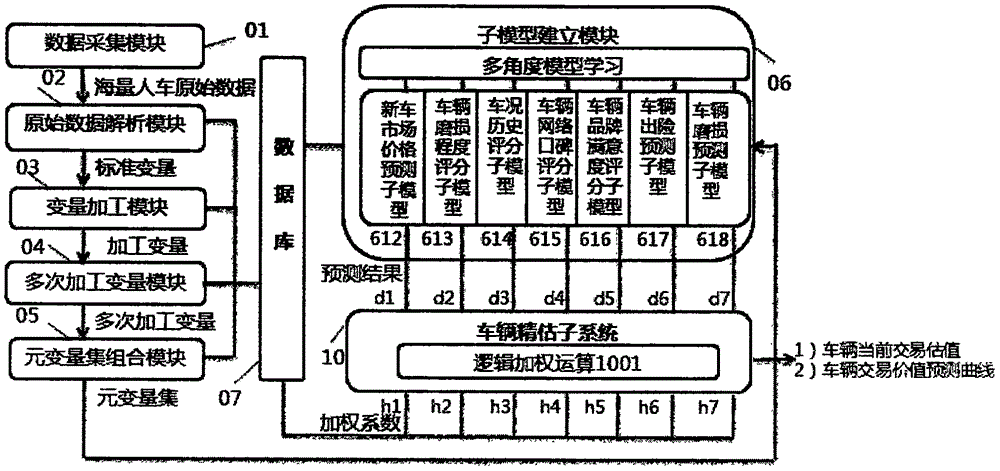

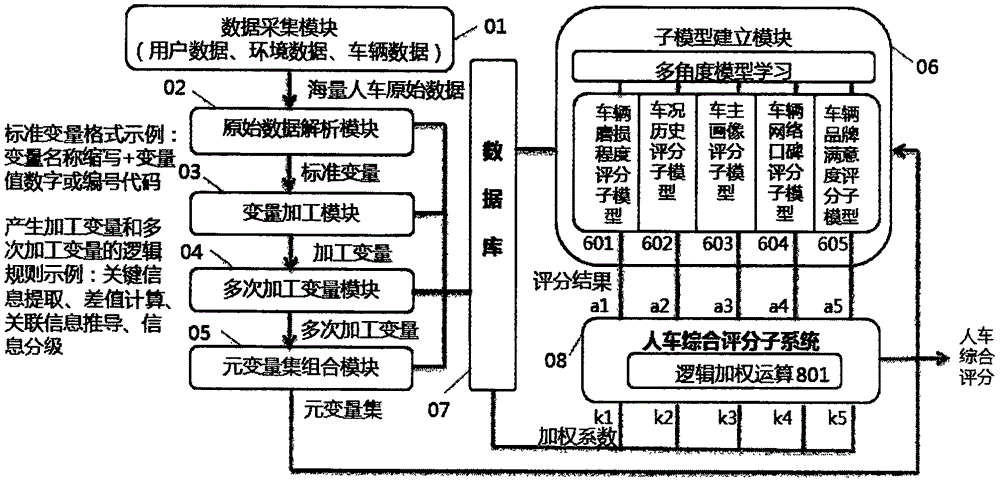

People-vehicle multifactorial assessment method and system based on big data

InactiveCN106022787AIncrease valueResolve asymmetryFinanceCommerceInformation processingQuality assurance

The invention discloses a people-vehicle multifactorial assessment method and system based on big data. The system performs analysis and specific logic rule analysis on obtained people, vehicle and environment mass data, and generates a criterion variable, a processing variable, a multitime processing variable and a metavariable set. Through a multi-angle model learning method, sub-models are established, and based on the sub-models, the system performs logic weight operation, and separately establishes a people-vehicle comprehensive assessment subsystem 08, a vehicle quality guarantee assessment subsystem 09, a vehicle fine assessment subsystem 10 and a vehicle owner credit analysis subsystem 11. The method and system can accurately realize people, vehicle and environment fragmentation information processing and positioning, radically solve the problem of information asymmetry of contracting parties in second-hand vehicle trading, and lack of quality assurance after second-hand vehicle multiple trading, increase vehicle re-trading values, meanwhile provide innovational business in the automobile insurance, automobile finance, automobile maintenance, automobile design and automobile related areas, and have great market values.

Owner:王琳

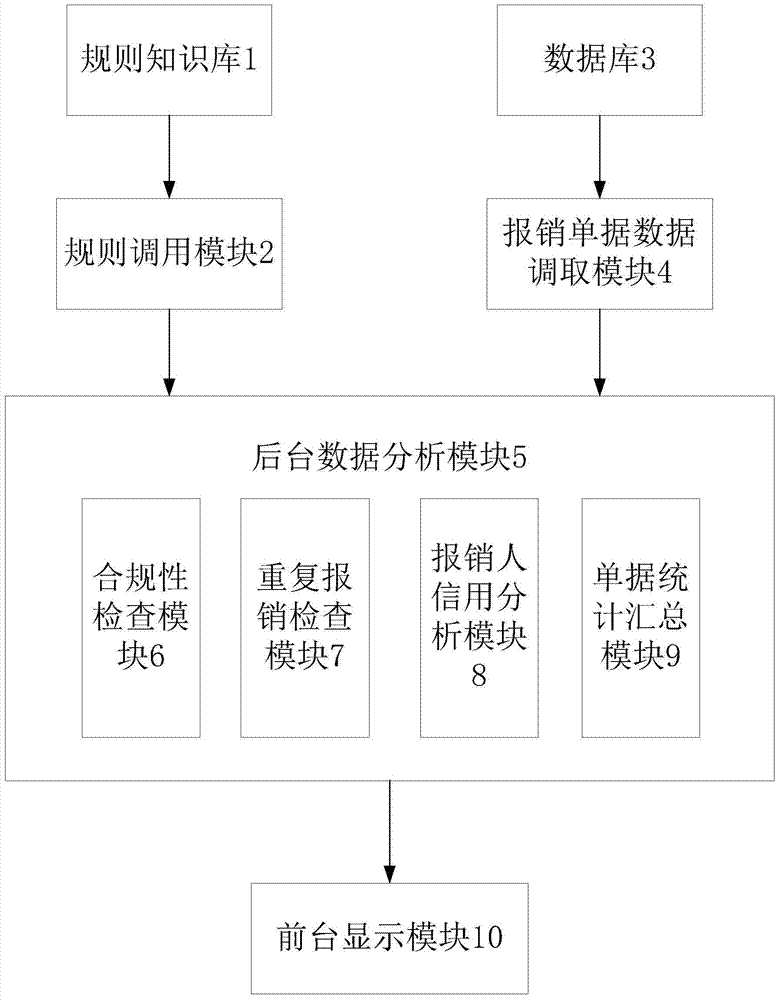

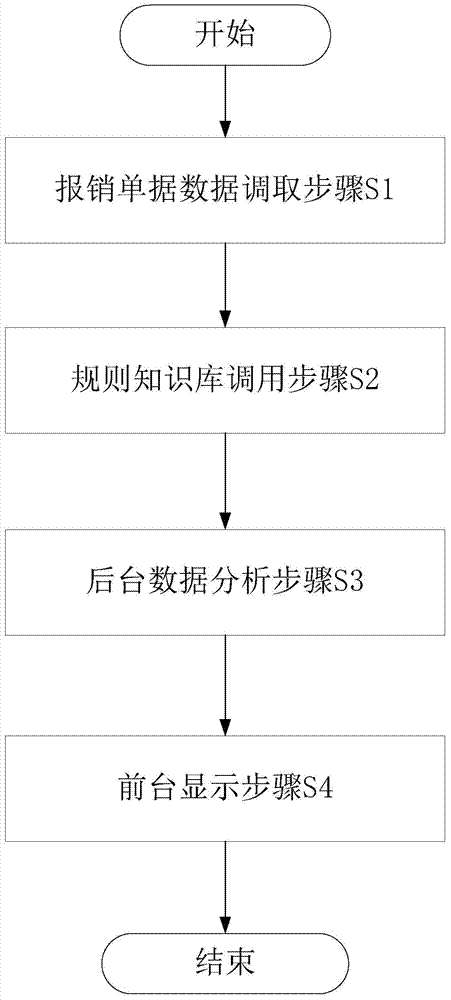

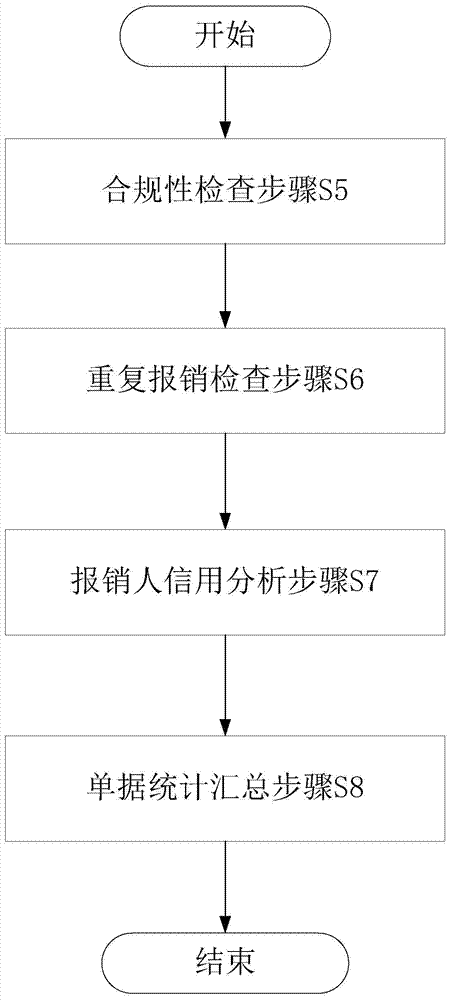

Reimbursement document auxiliary examination and approval method and apparatus

InactiveCN106934586AAccurate Approval DecisionReduce approval rateFinanceOffice automationGraphicsData retrieval

The present invention provides a reimbursement document auxiliary examination and approval method and apparatus. The method includes a reimbursement document data retrieval step, a rule knowledge base calling step, a background data analysis step and a foreground display step, wherein the background data analysis step further comprises a compliance checking step, a repeated reimbursement checking step, a reimbursement applicant credit analysis step and a document statistical summary step. When performing examination and approval, an approver can check the analysis results of a foreground display interface timely, wherein the analysis results include horizontal and vertical comparison data presented in a graph form and document abnormity point summaries presented in a table form; and the approver can make more accurate approval decisions according to these auxiliary information. The apparatus includes modules which provide implementation steps for the method. According to reimbursement document auxiliary examination and approval apparatus, documents to be examined and approved and historical reimbursement documents related to current reimbursement documents are automatically called and analyzed, and therefore, the efficiency and quality of examination and approval can be improved, the pass rate of unreasonable reimbursement documents can be decreased, and enterprises costs can be saved.

Owner:YGSOFT INC

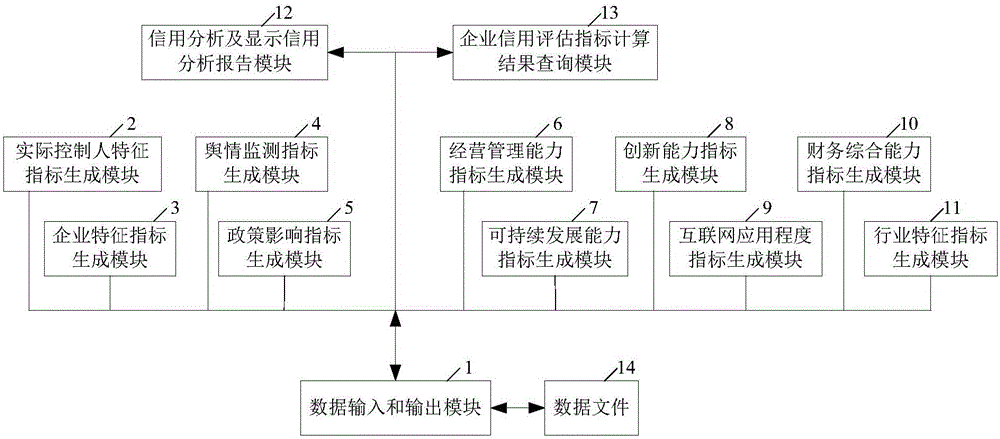

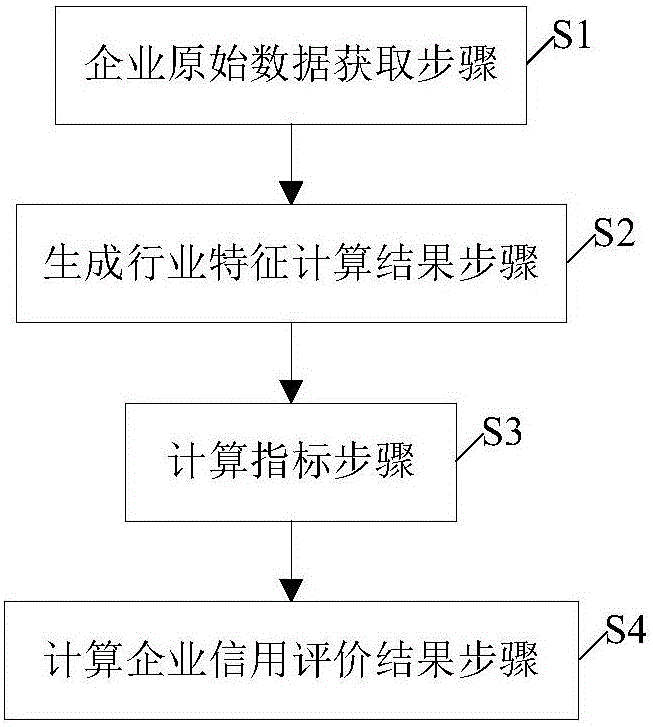

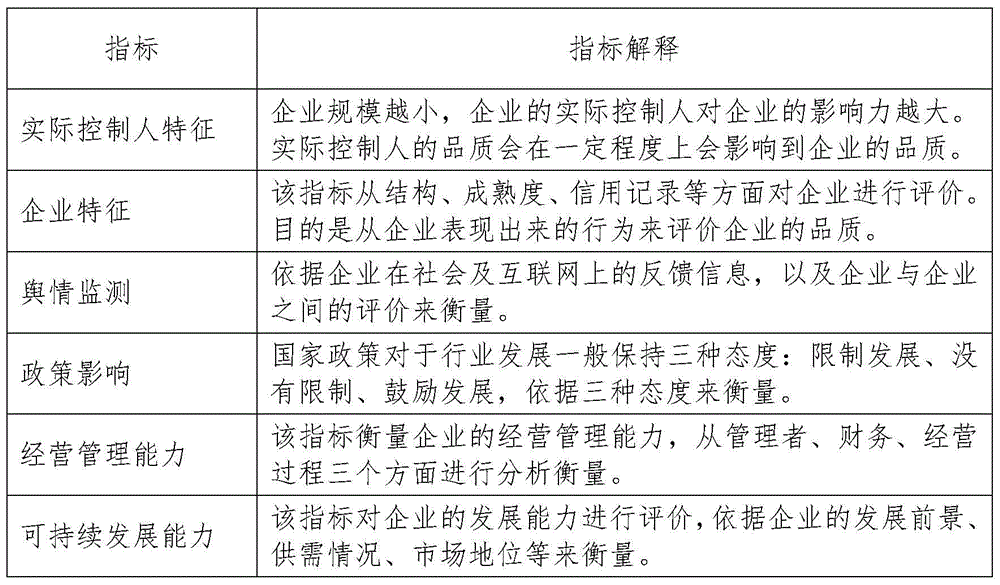

Enterprise credit evaluation system and method

InactiveCN105719073AImprove applicabilityObjective evaluationBuying/selling/leasing transactionsResourcesMedium enterprisesThe Internet

The invention discloses an enterprise credit evaluation system and method, wherein the system includes: a data input and output module, an actual controller characteristic index generation module, an enterprise characteristic index generation module, a public opinion monitoring index generation module, a policy influence index generation module, Operational management ability index generation module, sustainable development ability index generation module, innovation ability index generation module, Internet application degree index generation module, financial comprehensive ability index generation module, industry characteristic index generation module, credit analysis and display credit analysis report module and The enterprise credit evaluation index calculation result query module fully combines the characteristics of domestic large-scale and small and medium-sized enterprises, expands the application range of the enterprise credit evaluation system, and has good applicability.

Owner:SUZHOU HYT DATA TECH CO LTD

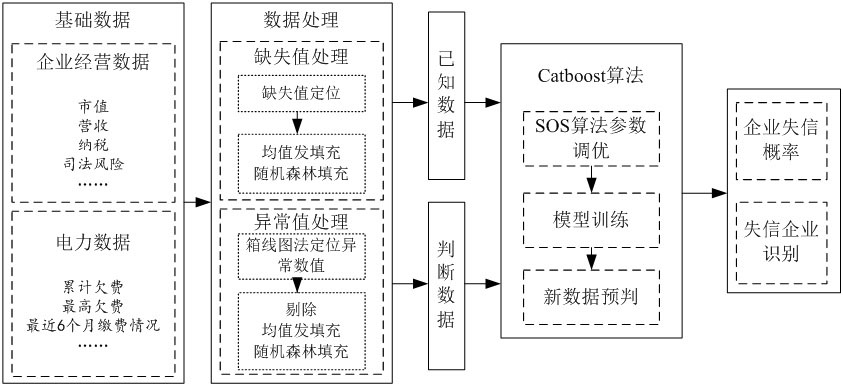

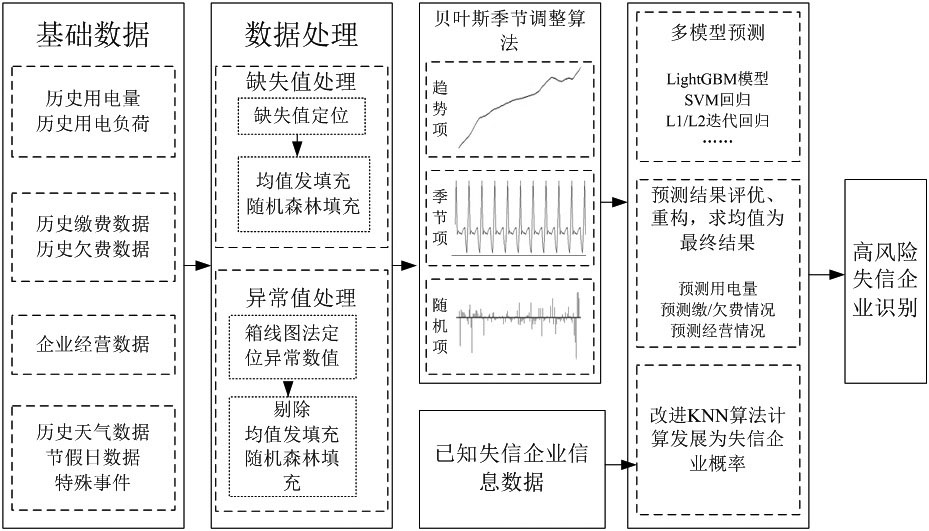

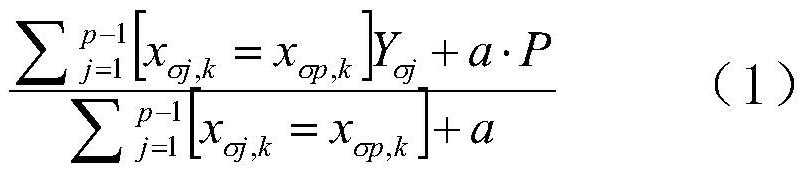

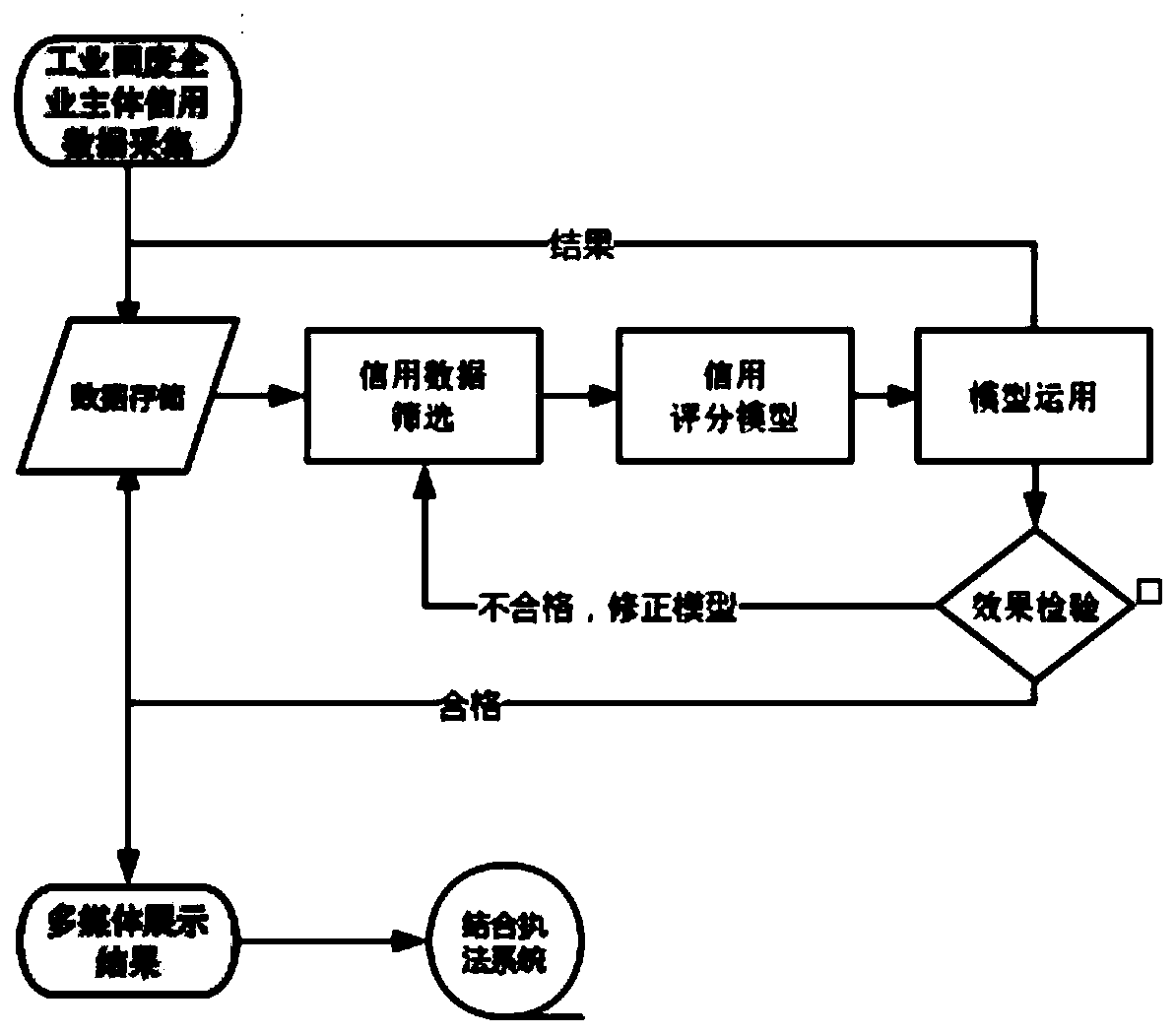

Electric power credit investigation evaluation method based on big data model

ActiveCN111612323AReduce noiseRich dimensionForecastingCharacter and pattern recognitionBusiness enterprisePower usage

The invention relates to an electric power credit investigation evaluation method based on a big data model. The method comprises the steps of collecting internal enterprise power data and external enterprise operation data; building credit loss power utilization enterprise features and high-risk credit loss power utilization enterprise features, building an enterprise credit investigation evaluation model for enterprise credit scoring by adopting an AHP analytic hierarchy process and a TOPSIS comprehensive evaluation method, determining a threshold value, and determining a user credit ratingaccording to a score range. According to the method, the dimension is more comprehensive, and the data reliability is higher; the method is advanced, the result is more accurate, and the enterprise credit analysis dimension is increased.

Owner:STATE GRID HEBEI ELECTRIC POWER RES INST +3

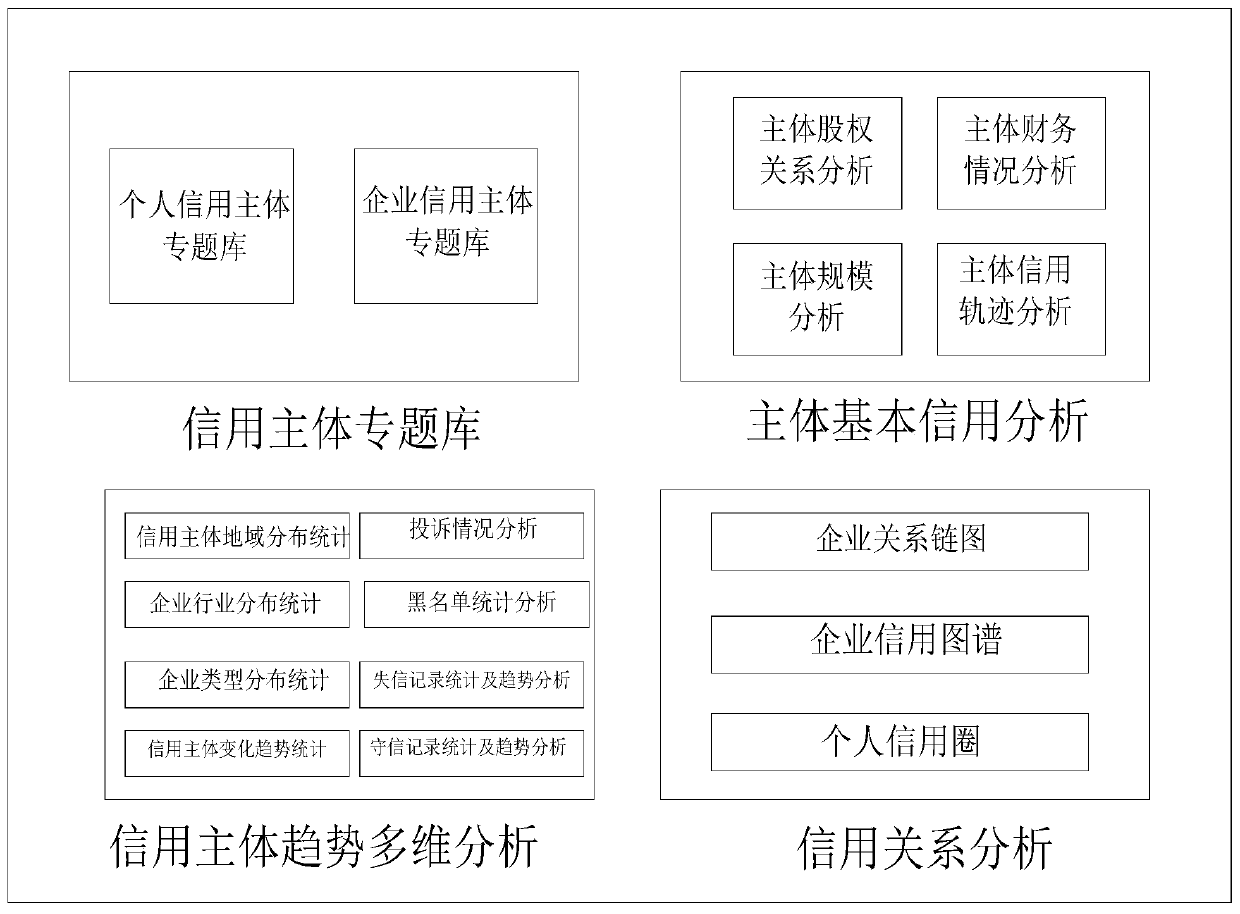

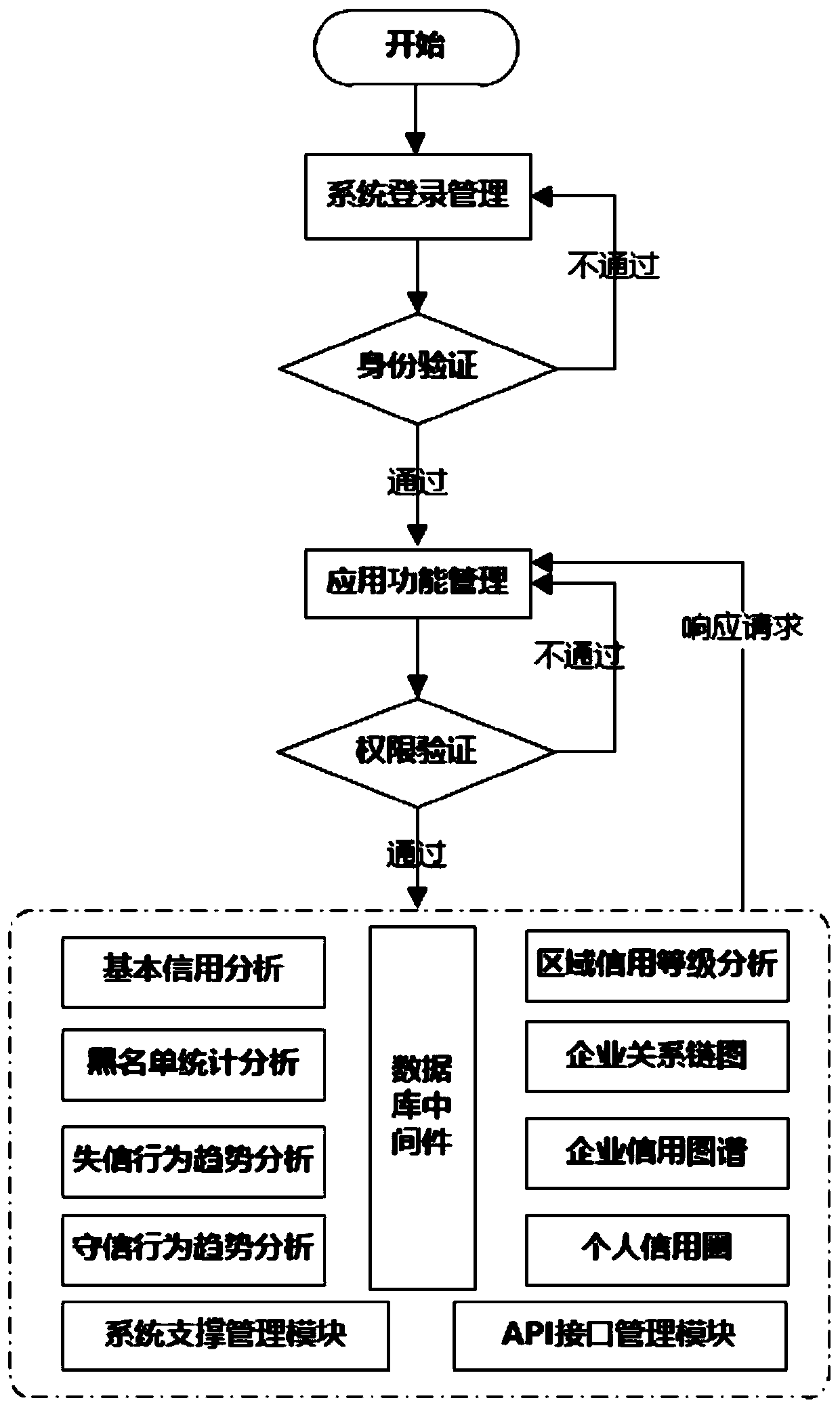

A credit subject comprehensive analysis management system and method

ActiveCN109766359AEffective supervisionEnhancing Credit Supervision CapabilitiesDigital data information retrievalSpecial data processing applicationsModel managementEvent data

The invention discloses a credit subject comprehensive analysis management system and method. The system comprises a credit subject thematic library module, a subject basic credit analysis module, a credit subject trend multi-dimensional analysis module and a credit relation analysis module. The invention mainly aims to solve the problems that credit evaluation standards of various supervision systems are not unified in a credit supervision construction process; various social subject credit data cannot be shared; credit analysis cannot be carried out according to regions, and the social subject credit index detection and the pre-event classification rating prediction functions are not exist, and aims to carry out the big data comprehensive analysis on two credit subjects of an enterpriseand a natural person, provides the credit supervision indexes and the model management of different dimensions, can realize the functions of pre-classification rating prediction, in-event data sharingjoint supervision and post-event trend assessment supervision, is helpful to the effective supervision and scientific decision making of a management department, and enables the credit supervision capability of market subjects to be enhanced and the whole social integrity level to be improved.

Owner:USTC SINOVATE SOFTWARE

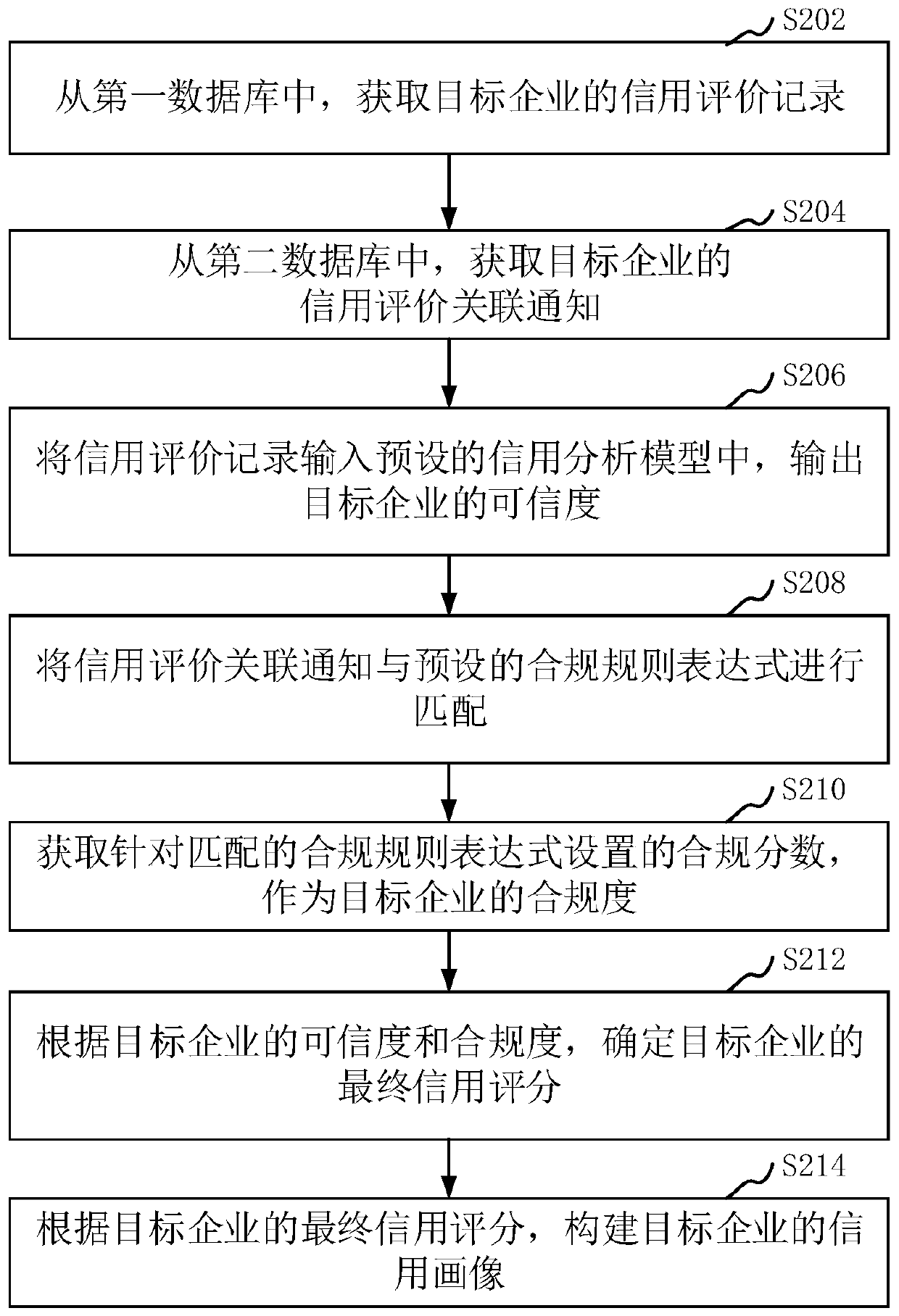

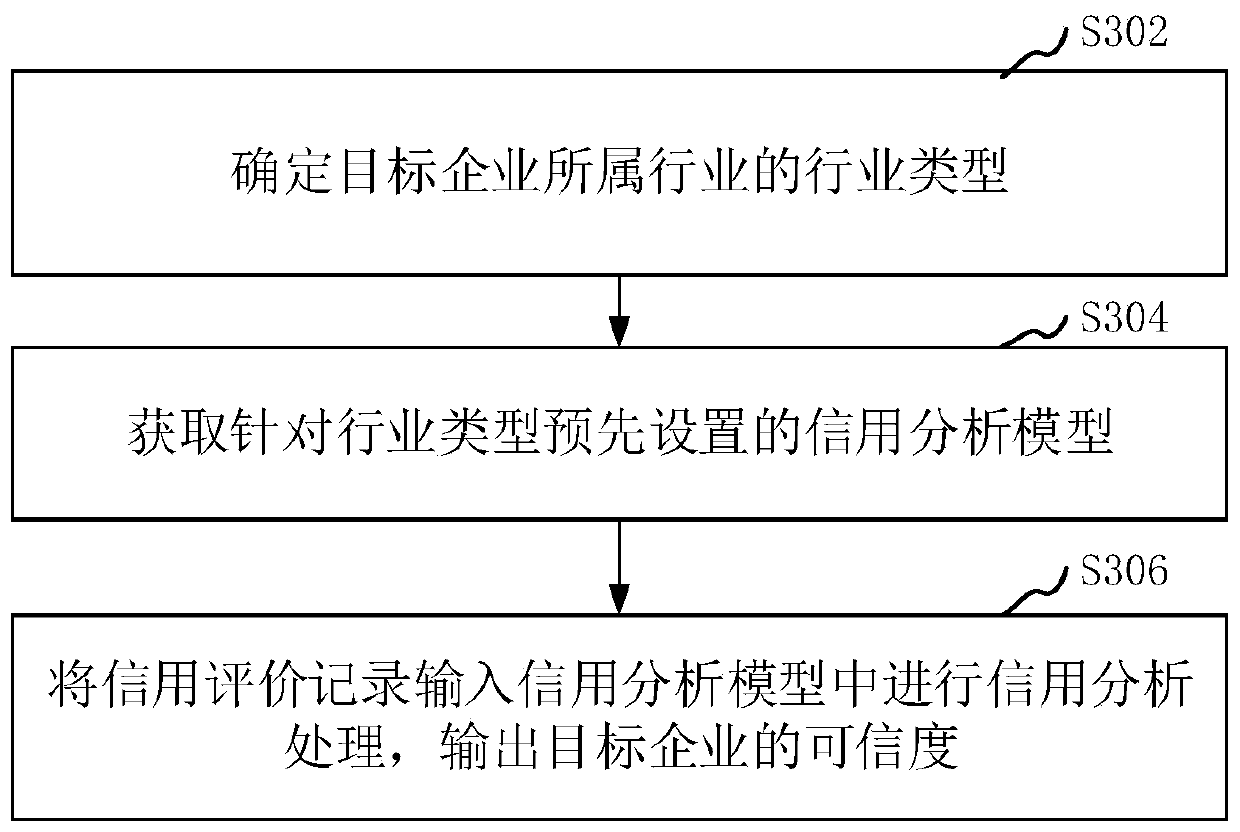

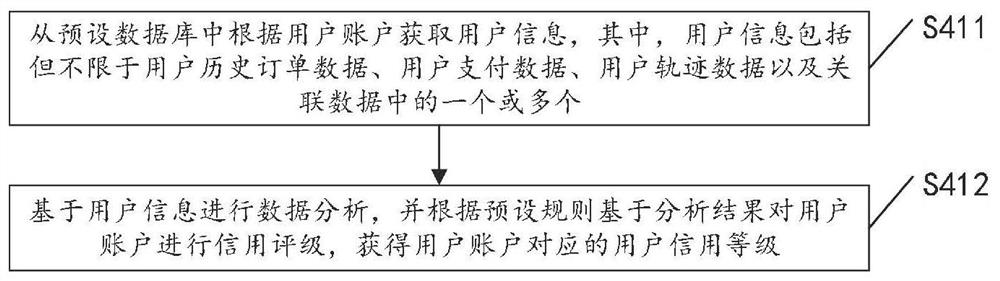

Enterprise credit evaluation method and device, computer device and storage medium

PendingCN109784707ACredit Rating ImprovementAccurate credit profileDatabase management systemsResourcesBig dataCredit analysis

The invention relates to an enterprise credit evaluation method and device based on big data, a computer device and a storage medium, and the method comprises the steps: obtaining a credit evaluationrecord of a target enterprise from a first database; obtaining a credit evaluation association notification of the target enterprise from a second database; inputting the credit evaluation record intoa preset credit analysis model, and outputting the credibility of the target enterprise; matching the credit evaluation association notification with a preset compliance rule expression; obtaining acompliance score set for the matched compliance rule expression as the compliance degree of the target enterprise; determining a final credit score of the target enterprise according to the credibility and the compliance of the target enterprise; and constructing a credit portrait of the target enterprise according to the final credit score of the target enterprise. By adopting the method, the enterprise credit assessment accuracy can be improved.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

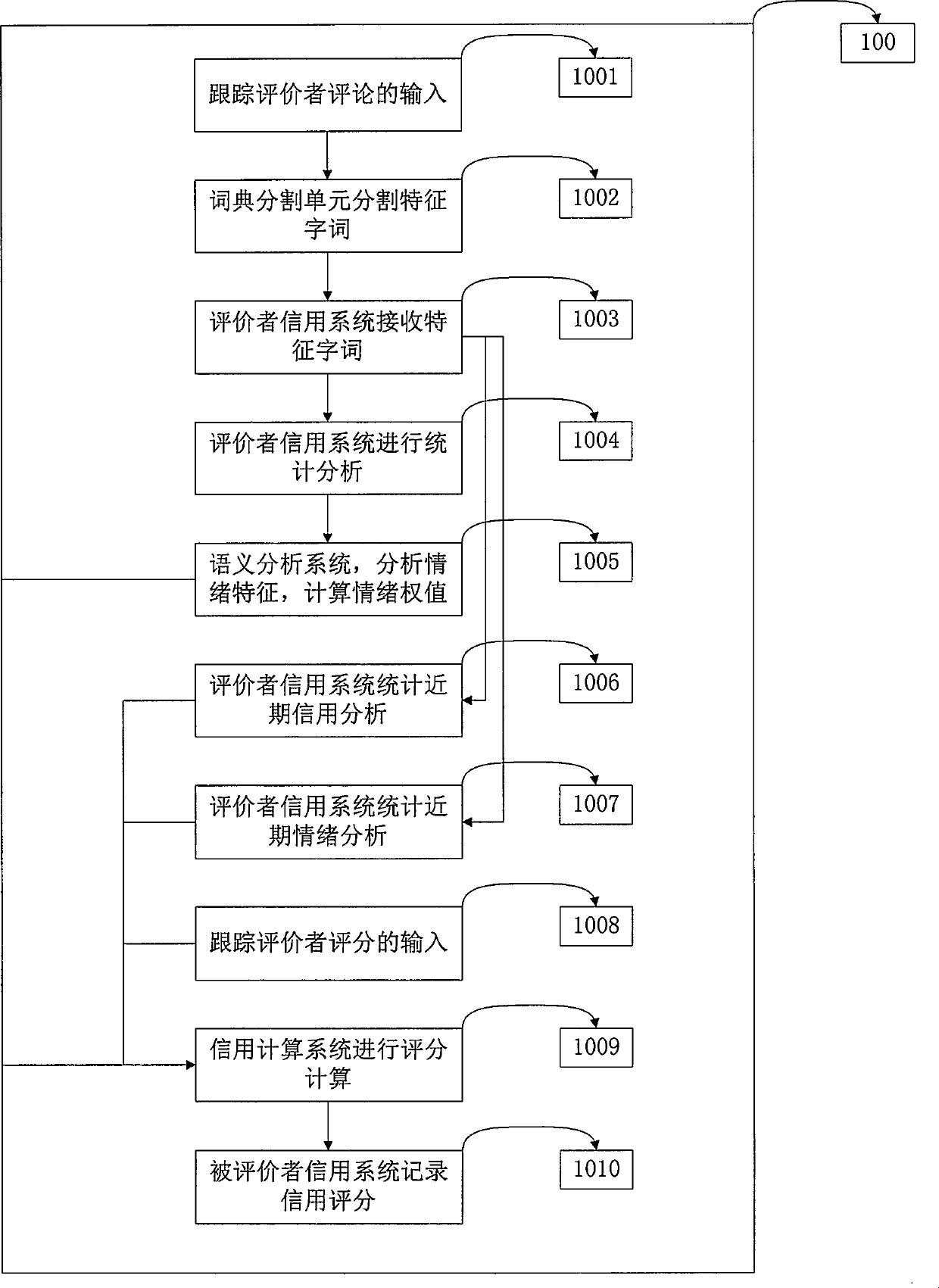

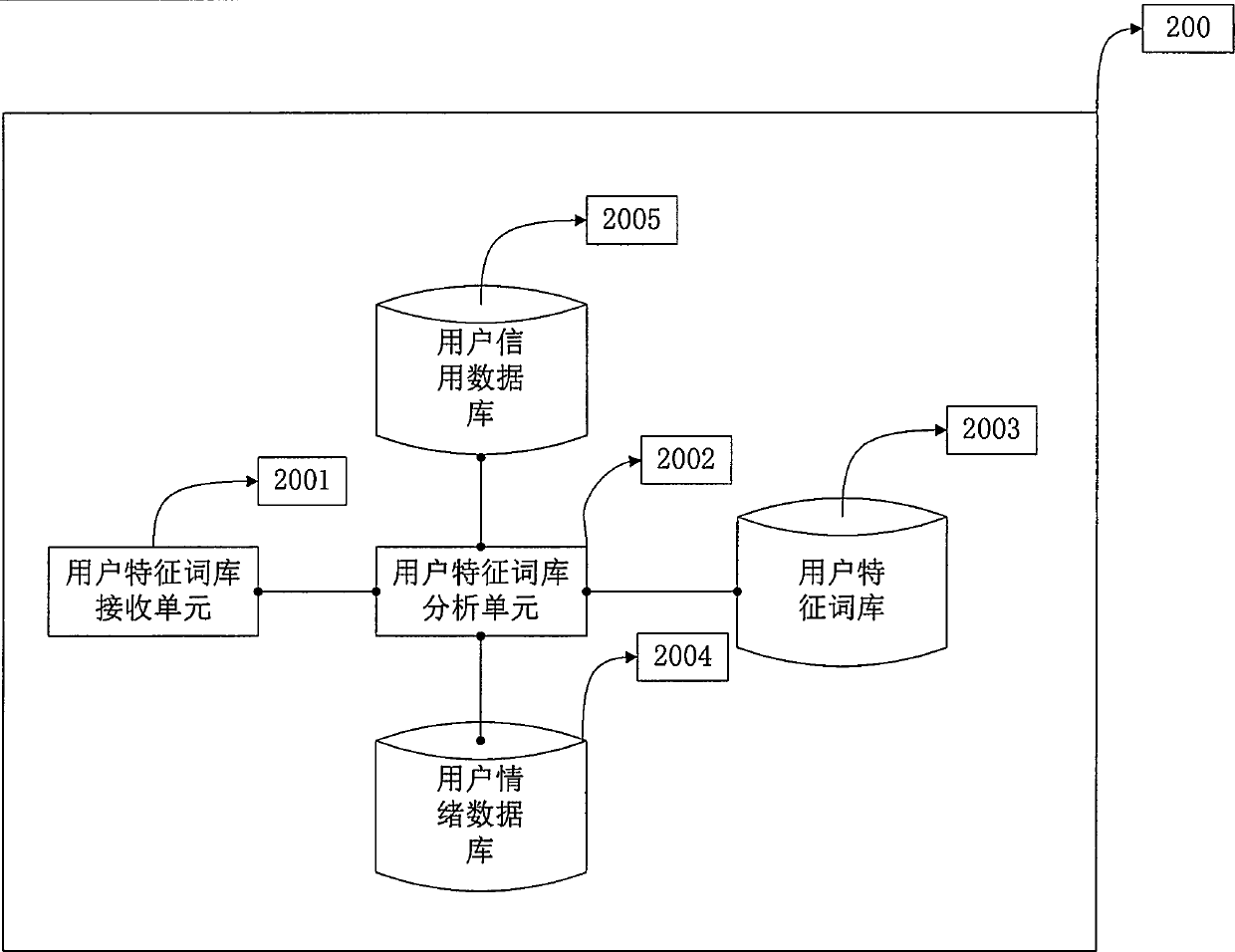

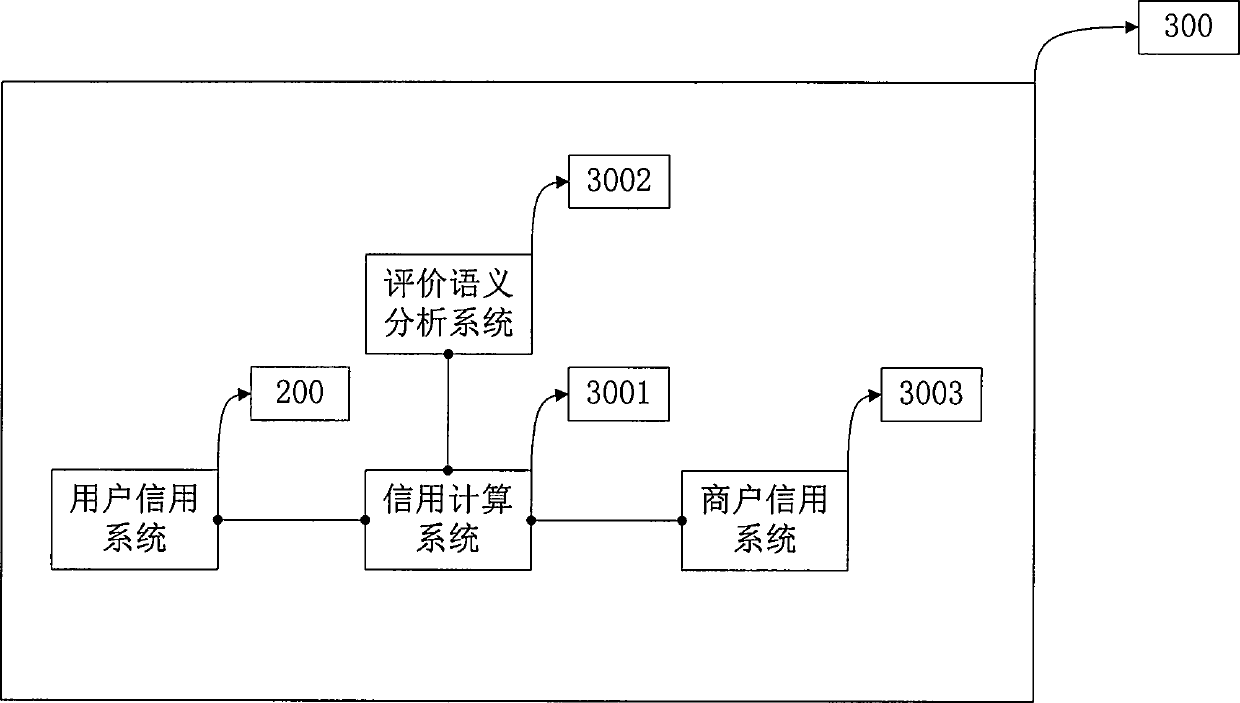

Dual-feedback credit assessment system and method based on emotion and credit

InactiveCN103345688AActive adjustment of emotional weightReduce the impactCommerceSpecial data processing applicationsCredit systemStatistical analysis

The invention relates to a semantic recognition technology, a machine learning technology and a networked transaction credit assessment technology and discloses a dual-feedback credit assessment system and method based on emotion and credit, wherein the system and method overcome the defect that the existing credit assessment technology is influenced too much by subjective factors. The system comprises a comment semantic analysis system, a user credit system, a merchant credit system and a credit calculation system. The method includes the steps that input of comments of an evaluator is tracked; a dictionary segmentation unit segments feature words; an evaluator credit database receives the feature words; the evaluator credit database performs statistical analysis; the semantic analysis system analyzes emotional features and calculates the emotion weight; the evaluator credit database performs statistics on recent credit analysis; the evaluator credit database performs statistics on recent emotion analysis; the input of scores of the evaluator is tracked; the credit calculation system calculates the scores; an evaluated party credit database records the credit scores. With the system and method, the too much influence of the subjective factors and credit factors on credit assessment can be effectively adjusted, so that the credit evaluation tends to be credible and fair.

Owner:倪慎瑜

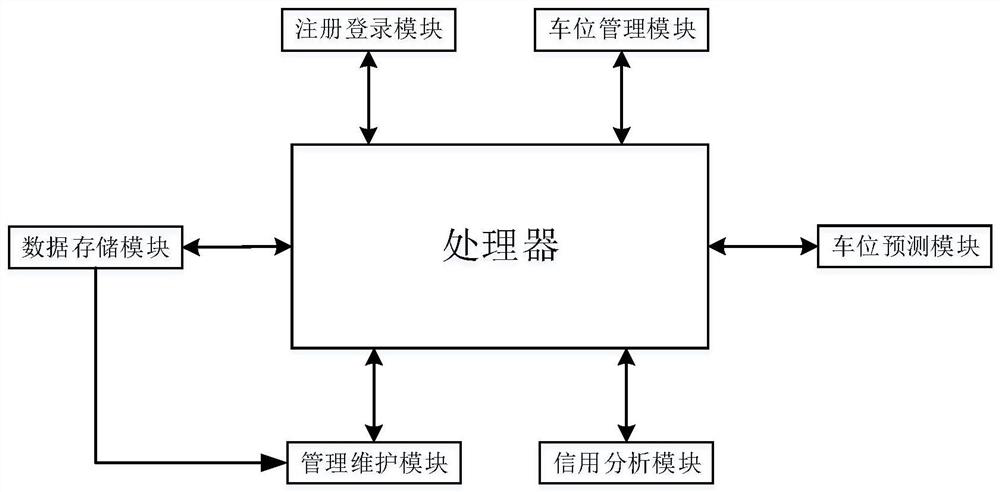

Smart park parking management system based on Internet

PendingCN112669474AContribute to the rational distributionAvoid wastingTicket-issuing apparatusIndication of parksing free spacesParking spaceThe Internet

The invention discloses a smart park parking management system based on the Internet, relates to the technical field of parking management, and solves the technical problem of insufficient utilization of parking space resources in the existing technical scheme. According to the invention, the registration and login module is arranged, so that a basis is provided for reasonable allocation of parking resources; the system is provided with a credit analysis module which is used for analyzing the parking reputation of a user; the credit analysis module calculates a user parking reputation evaluation coefficient through the parking record of the user, and obtains the parking reputation grade of the user according to the parking evaluation coefficient, thereby avoiding the waste of parking resources by the user, and facilitating the improvement of the management efficiency of parking spaces; and according to the invention, the parking space management module is arranged to control the entry and exit of vehicles according to the results of the credit analysis module and the registration and login module, and when the parking spaces in the smart park are insufficient, the parking spaces near the smart park are searched for users, thereby facilitating the full utilization of parking space resources.

Owner:安徽省经建技术有限公司

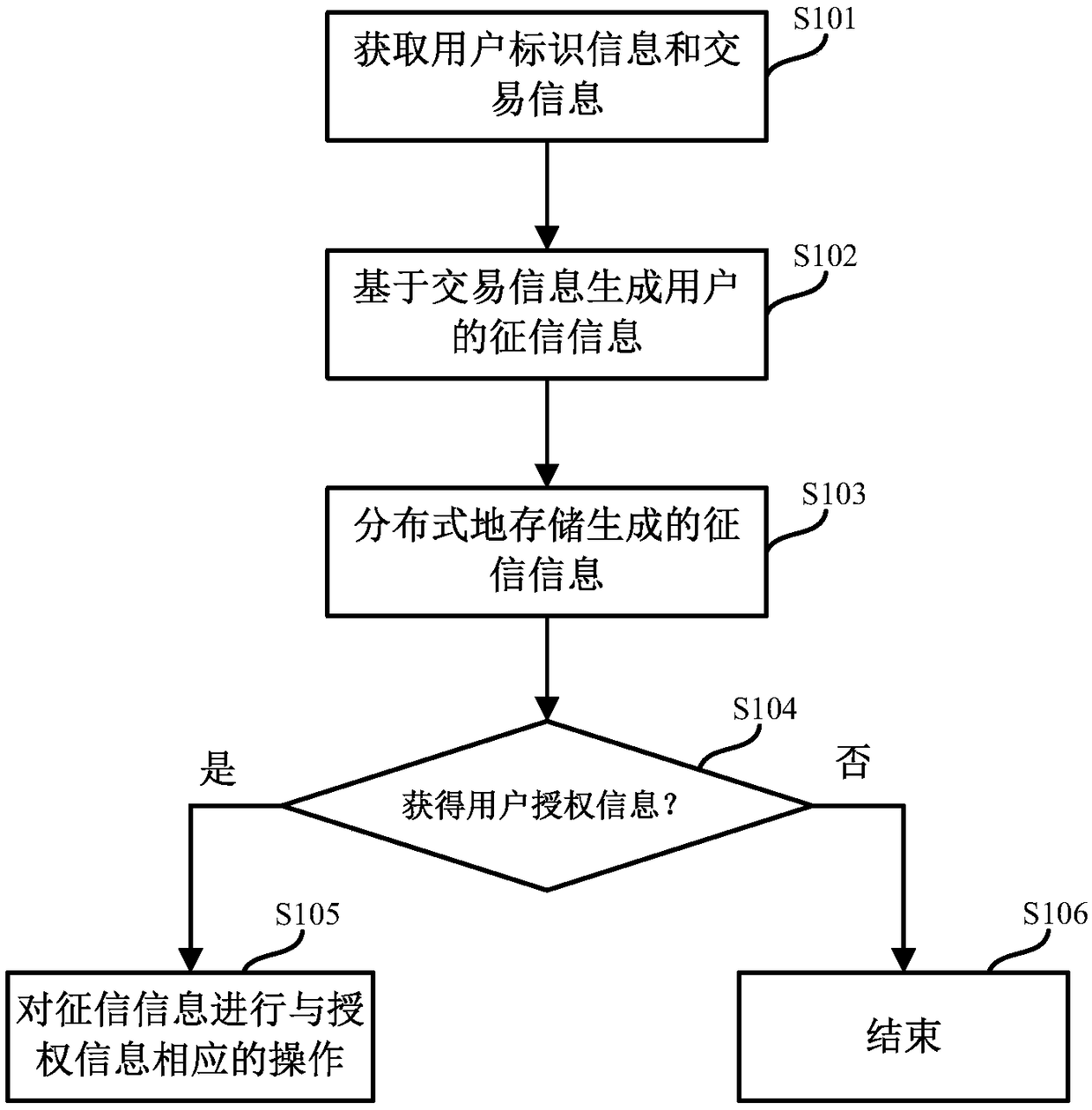

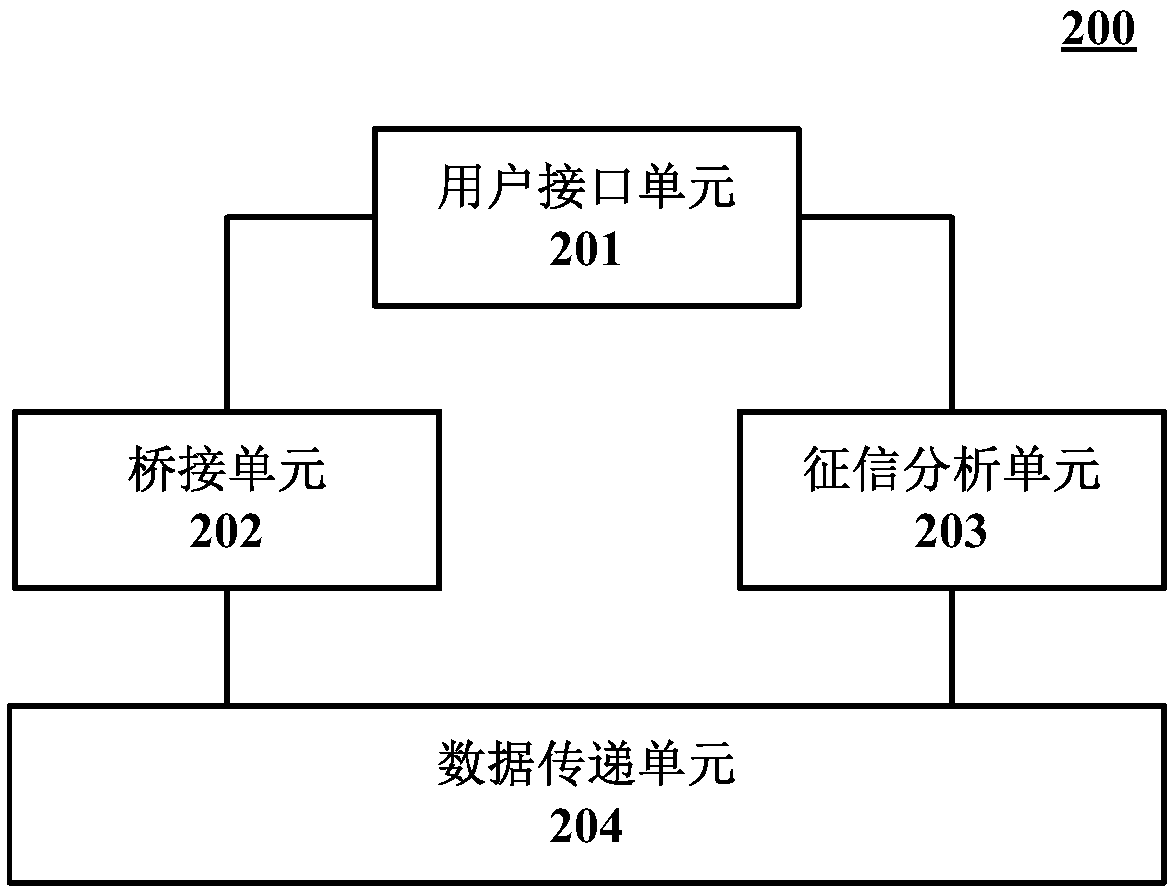

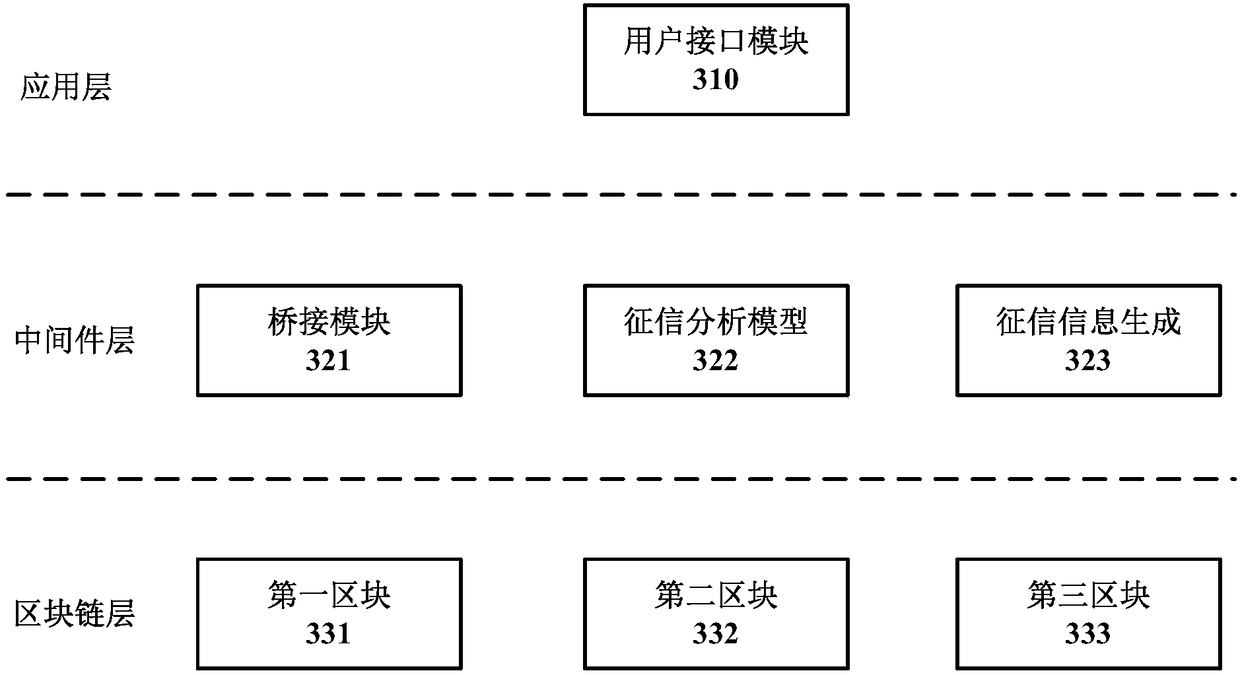

Credit information processing method

InactiveCN108537065AEasy to controlAvoid visitingFinanceDigital data protectionInformation processingAuthorization

The invention discloses a credit information processing method in a blockchain. The method comprises the steps that identification information of a user is obtained, transaction information of the user is determined on the basis of the identification information; by means of a specified credit analysis module, and on the basis of the transaction information of the user, credit information of the user is determined; authorization information of the user is obtained, and on the basis of the authorization information, operation on the credit information is determined. According to the technical scheme, the phenomenon that the credit information of the user is accessed and even tampered and forced under the condition of not obtaining the authorization of the user can be avoided.

Owner:ZHONGAN INFORMATION TECH SERVICES CO LTD

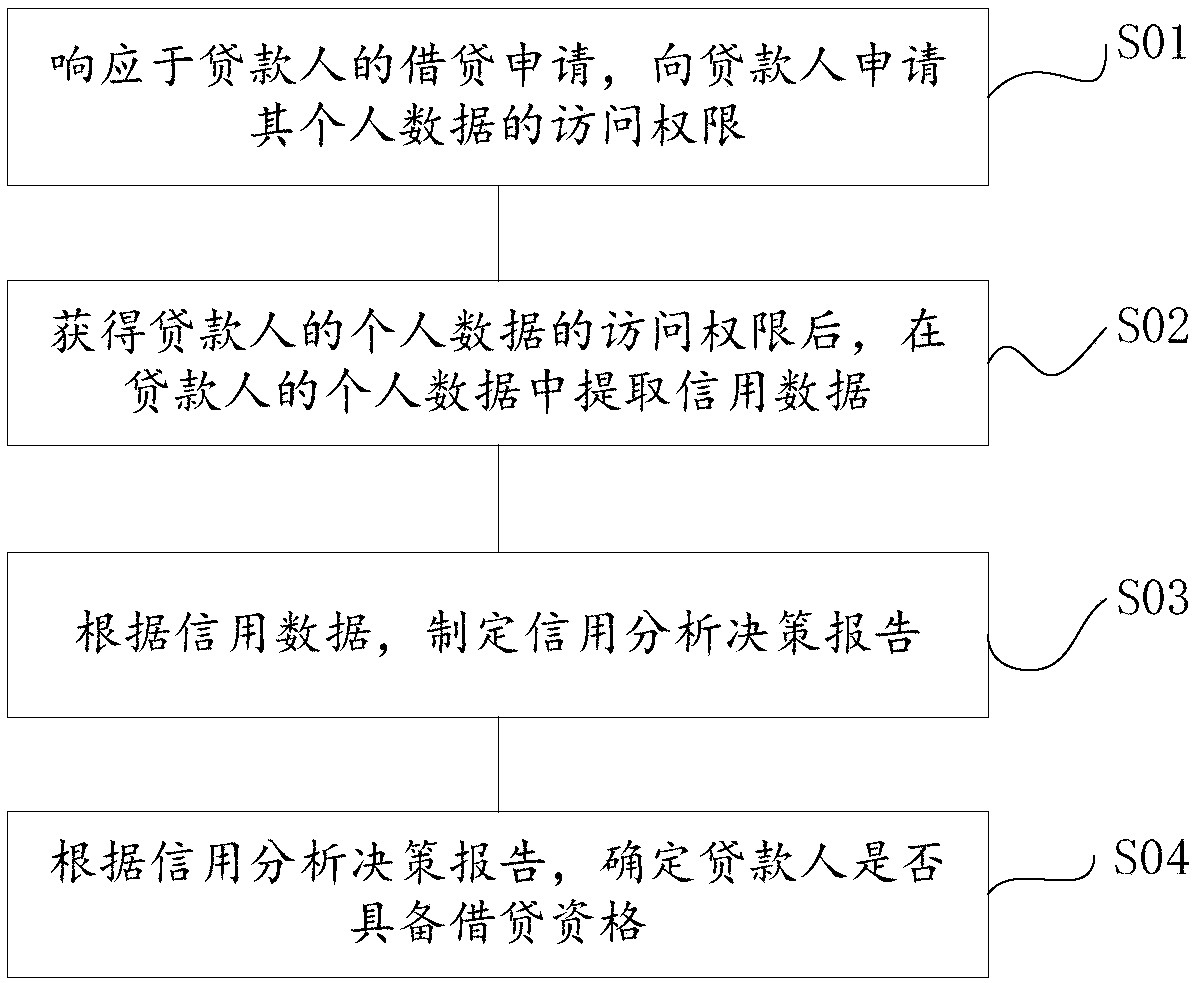

Credit eligibility assessment method and system for obtaining credit data online and storage medium

The invention discloses a credit eligibility assessment method and system for obtaining credit data online and a storage medium. The method comprises the following steps: in response to a lending application of a lender, applying to a lender for access rights of personal data; after obtaining access to personal data of the lender, extracting credit data from personal data of the lender; making a credit analysis decision report according to the credit data; according to the credit analysis decision report, determining whether the lender is eligible for borrowing or not. In the implementation process, the invention not only can effectively screen out redundant data, reduce workload, but also effectively avoid the problem that credit data is tampered with, at the same time, the information provided by the lender can be effectively protected, and the safety of the lender's personal data is improved.

Owner:上海分壳信息技术股份有限公司

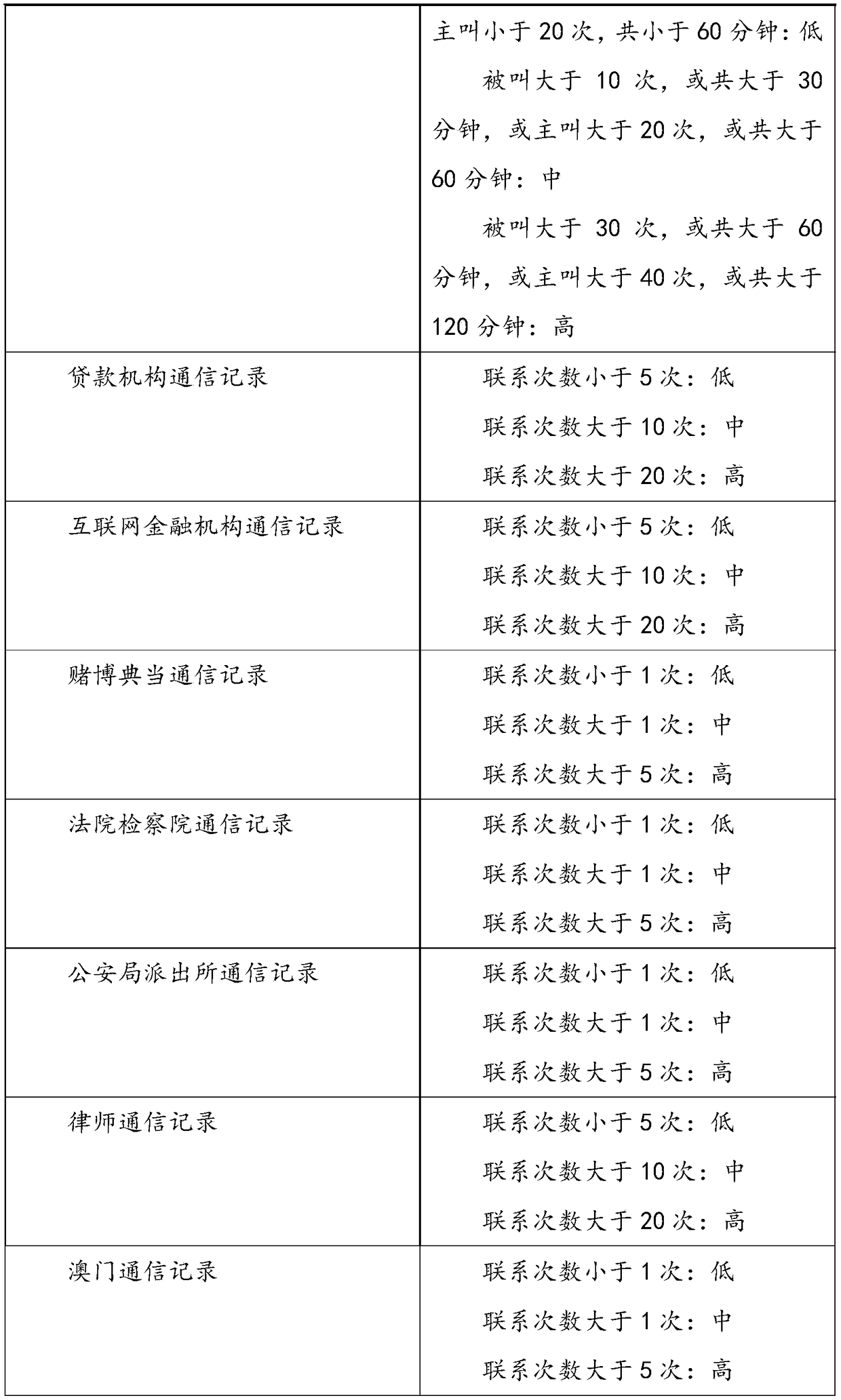

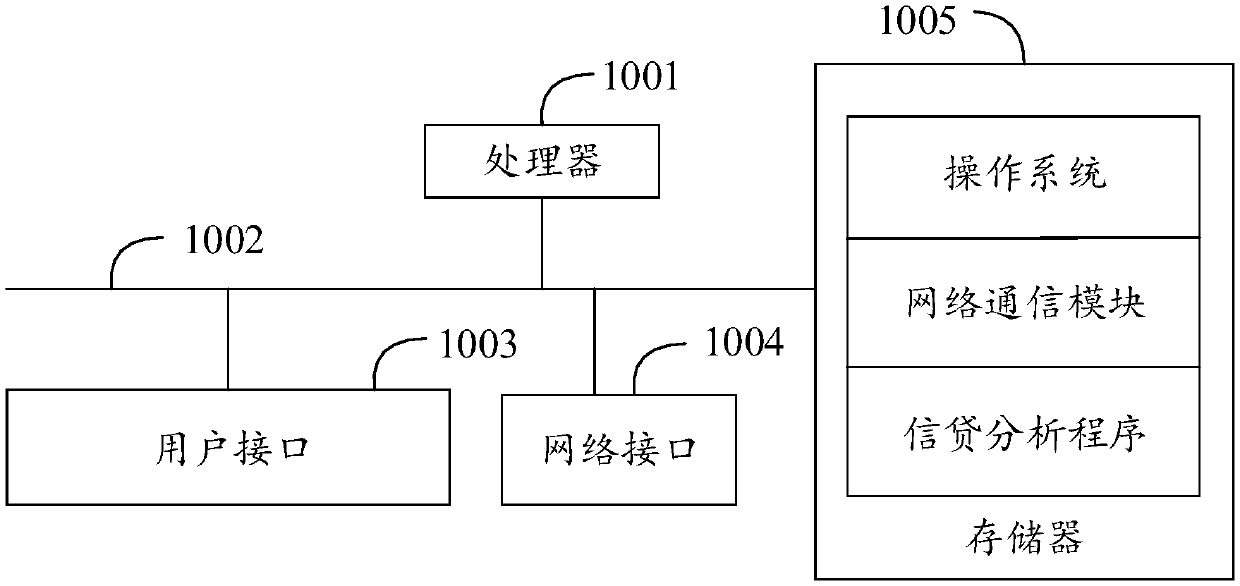

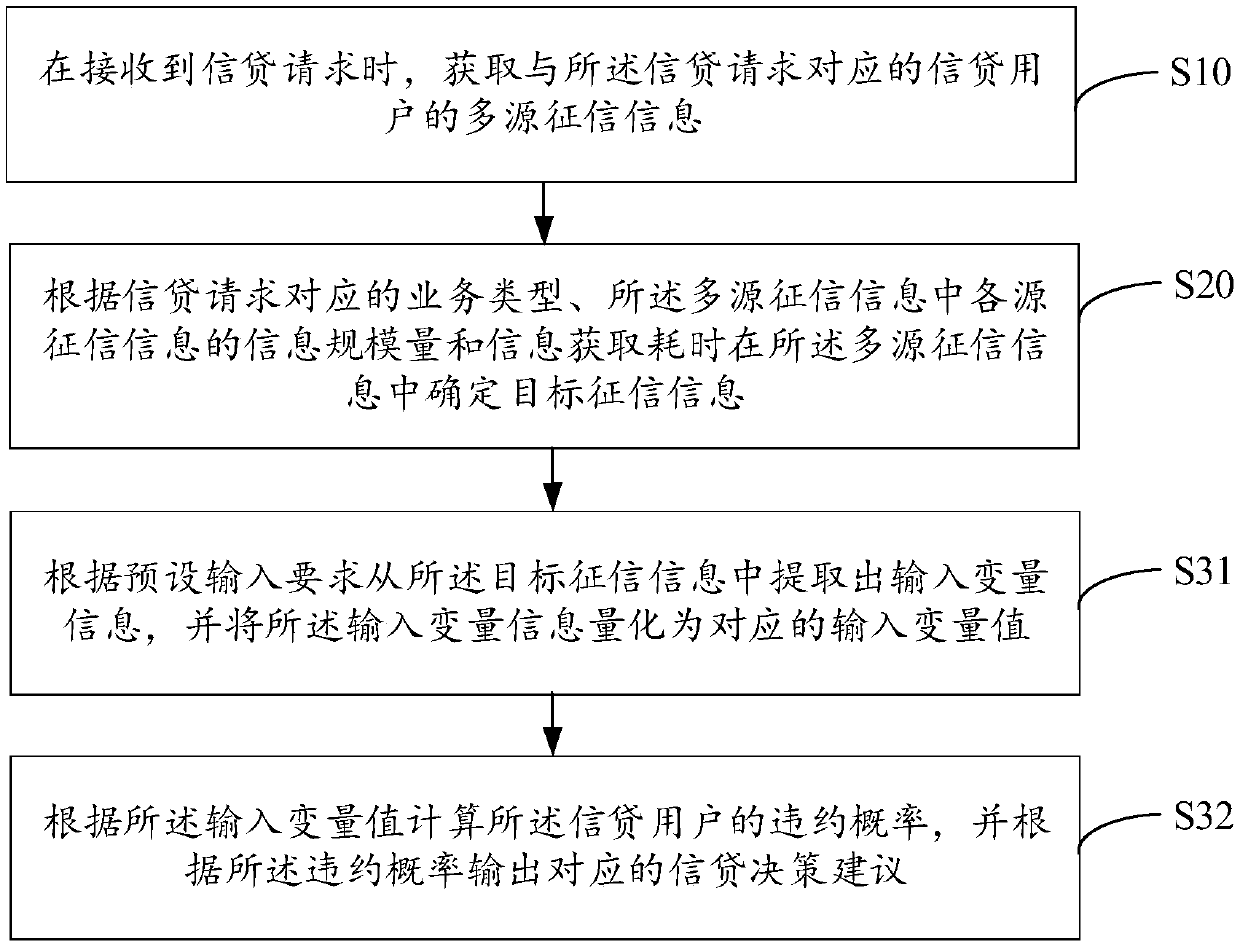

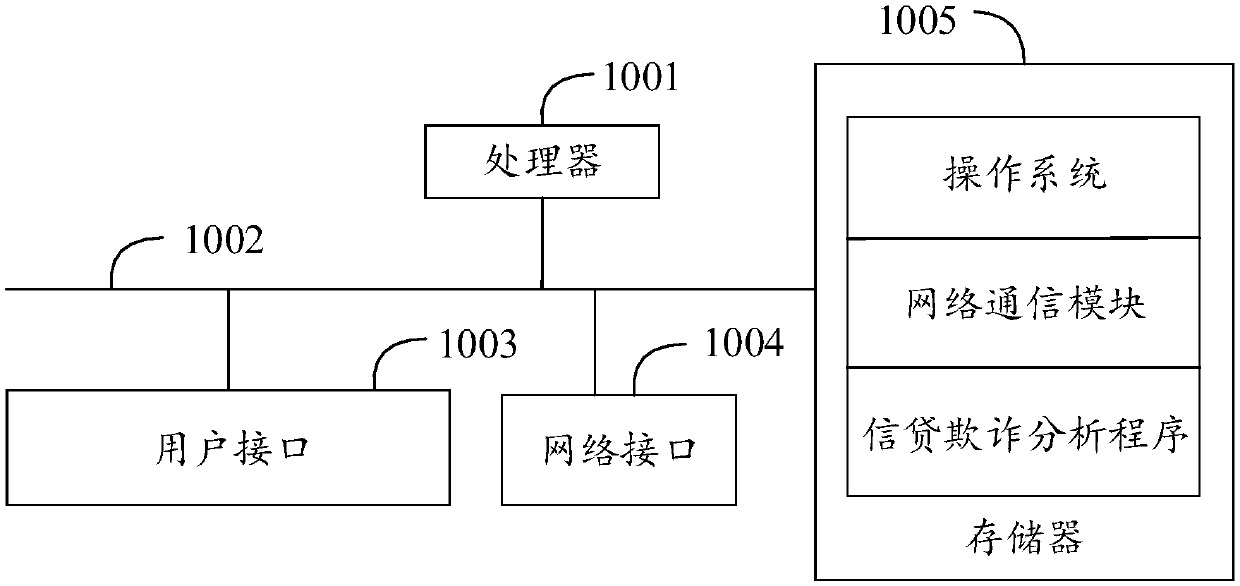

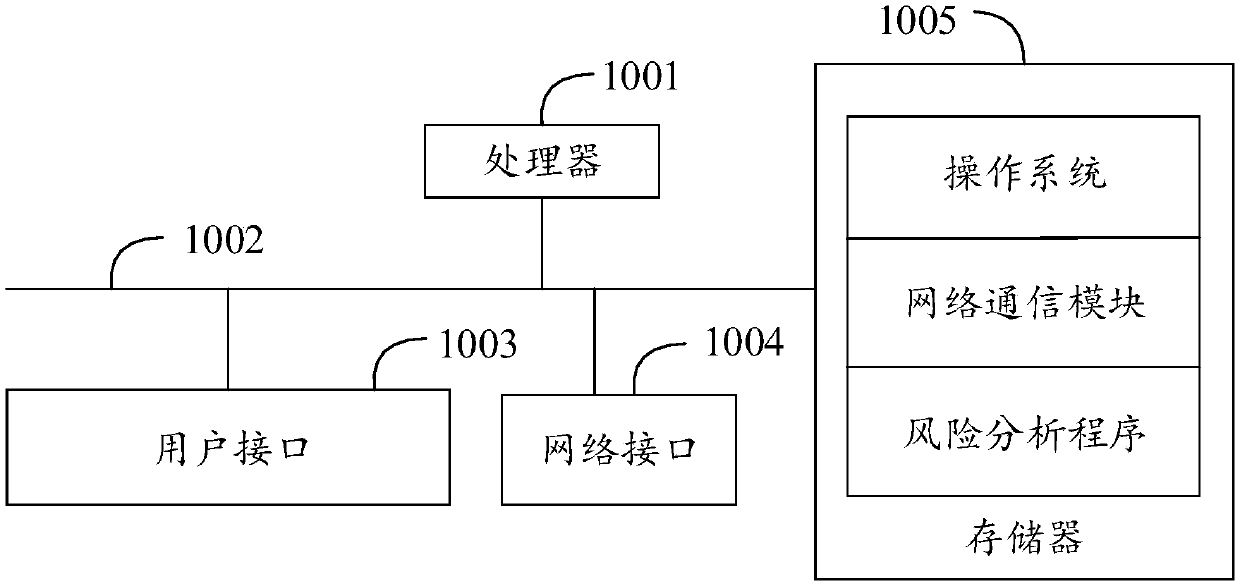

Credit analysis method, device and equipment and computer readable storage medium

The invention provides a credit analysis method, and the method comprises the steps: obtaining the multi-source credit information of a credit user corresponding to a credit request when the credit request is received; Determining target credit investigation information in the multi-source credit investigation information according to the business type corresponding to the credit request, the information scale quantity of each source credit investigation information in the multi-source credit investigation information and the information acquisition time consumption; And performing credit analysis according to the target credit investigation information, and outputting a corresponding credit decision suggestion according to an analysis result. The invention further provides a credit analysis device and equipment and a computer readable storage medium. According to the invention, when credit analysis needs to be carried out, credit information provided by a plurality of credit organizations is obtained; comprehensive consideration is performed on the multiple pieces of credit investigation information according to the three dimensions of the service recognition degree, the information scale amount and the information obtaining time, multi-source big data are analyzed, the most appropriate target credit investigation information is selected out, the target credit investigation information is analyzed, and related decision suggestions are given.

Owner:PINGAN PUHUI ENTERPRISE MANAGEMENT CO LTD

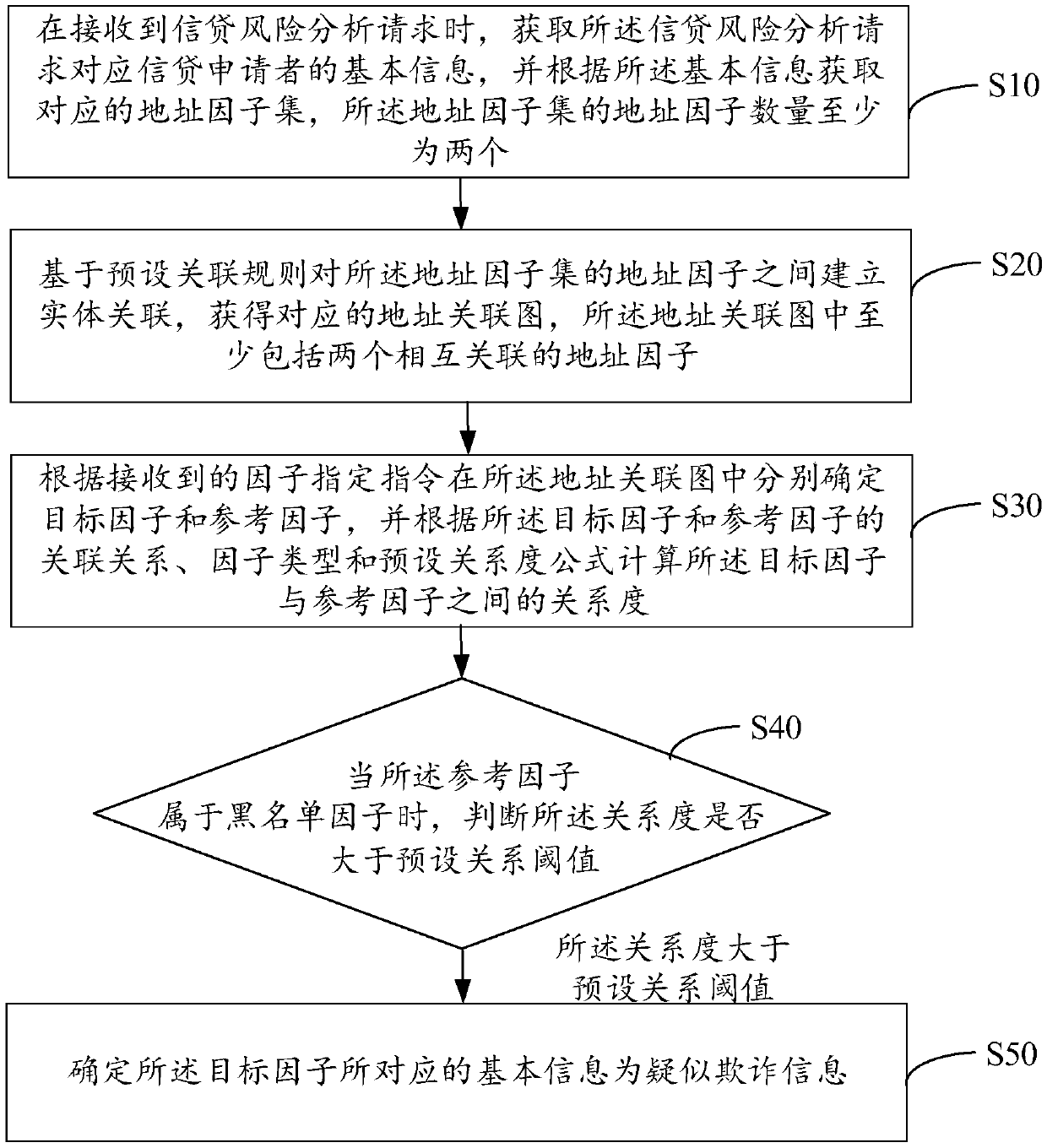

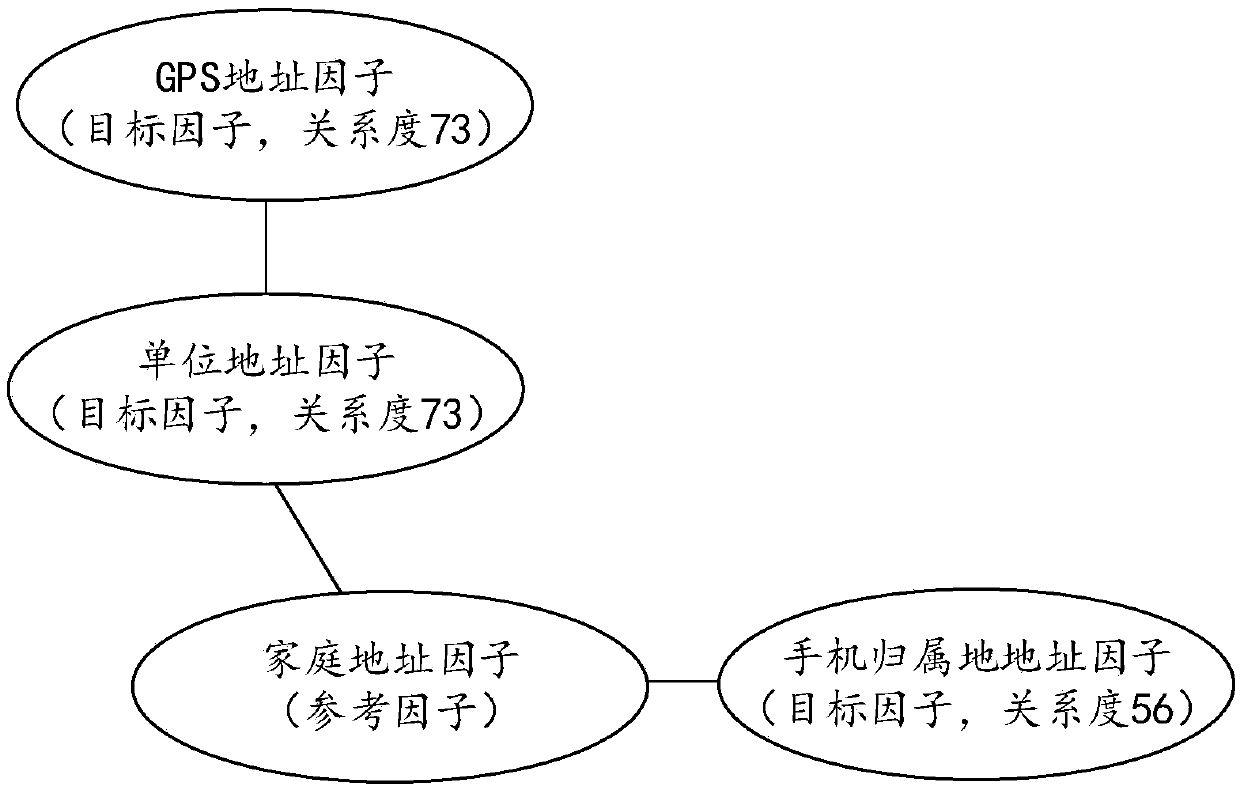

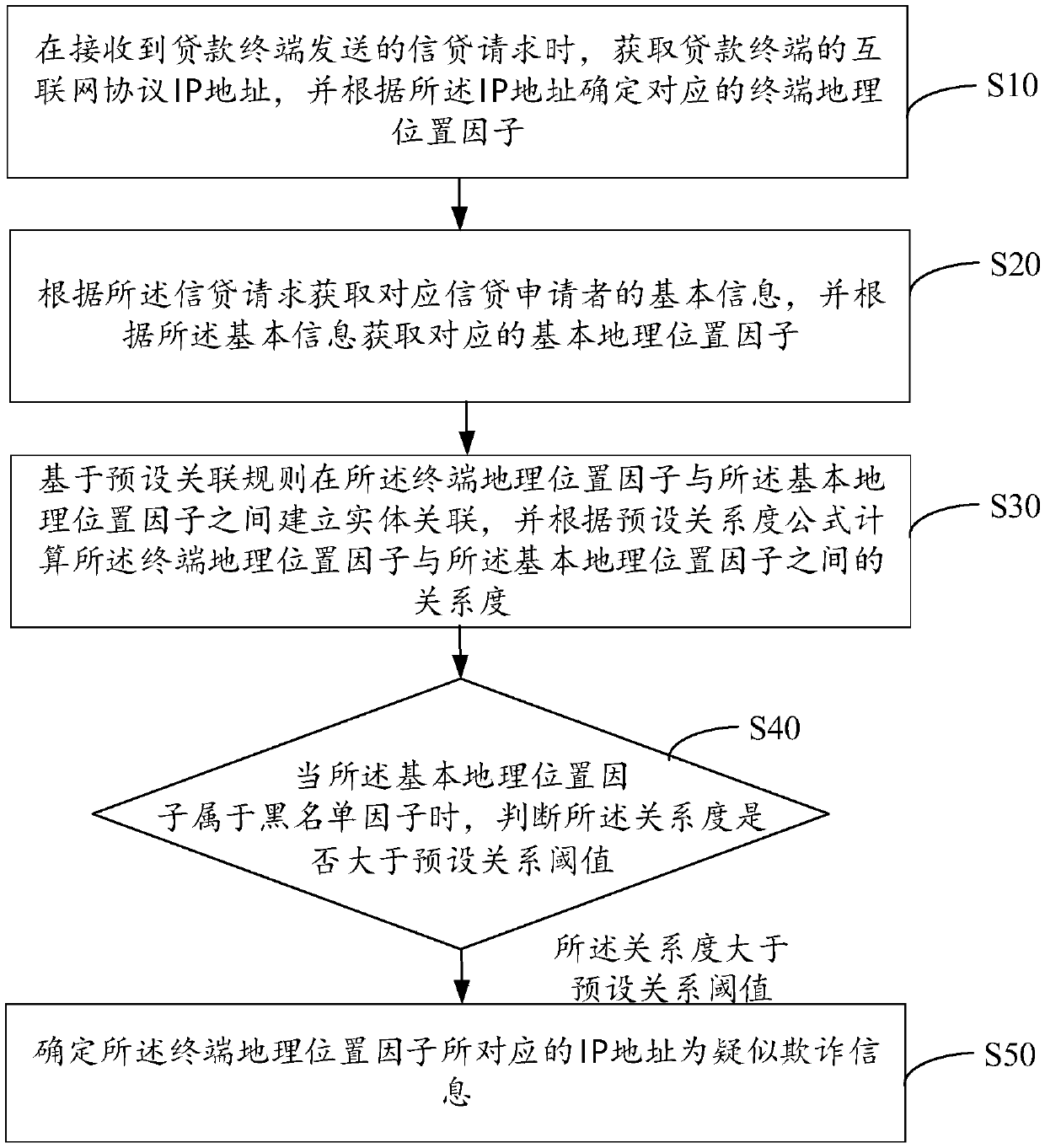

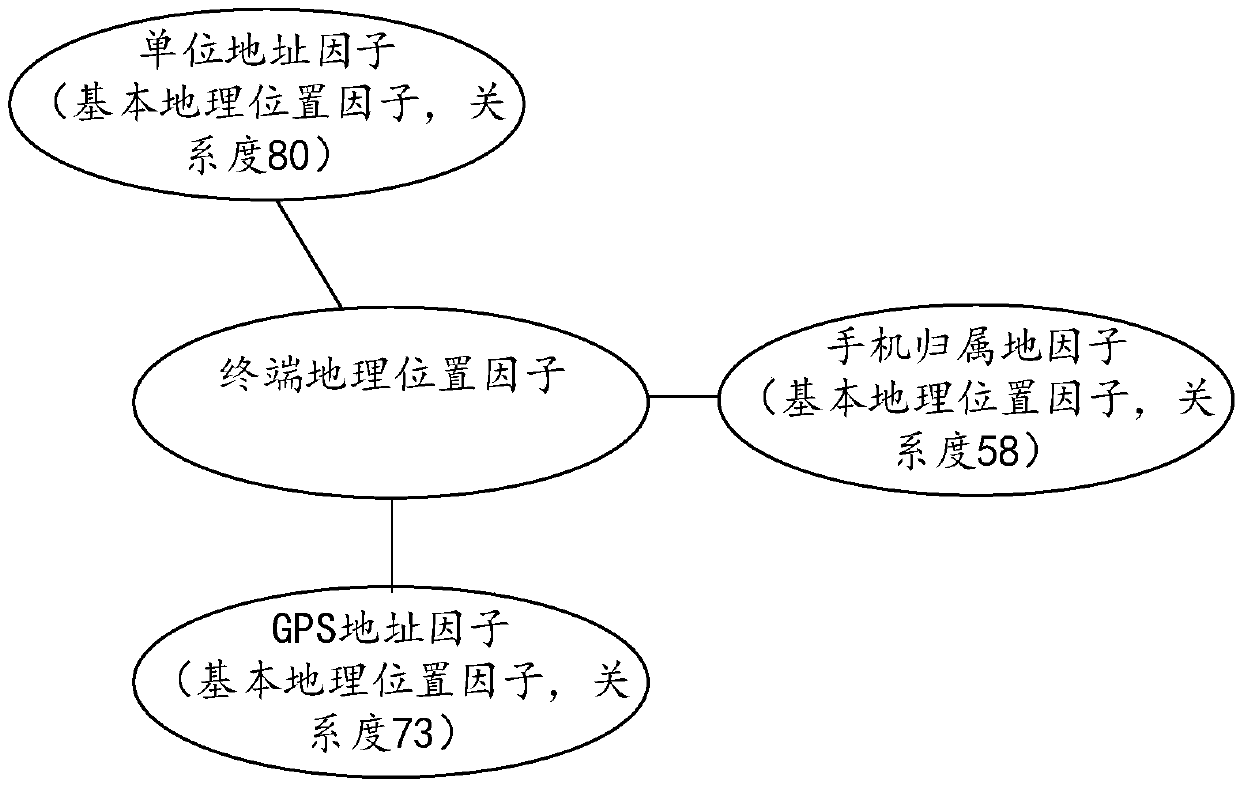

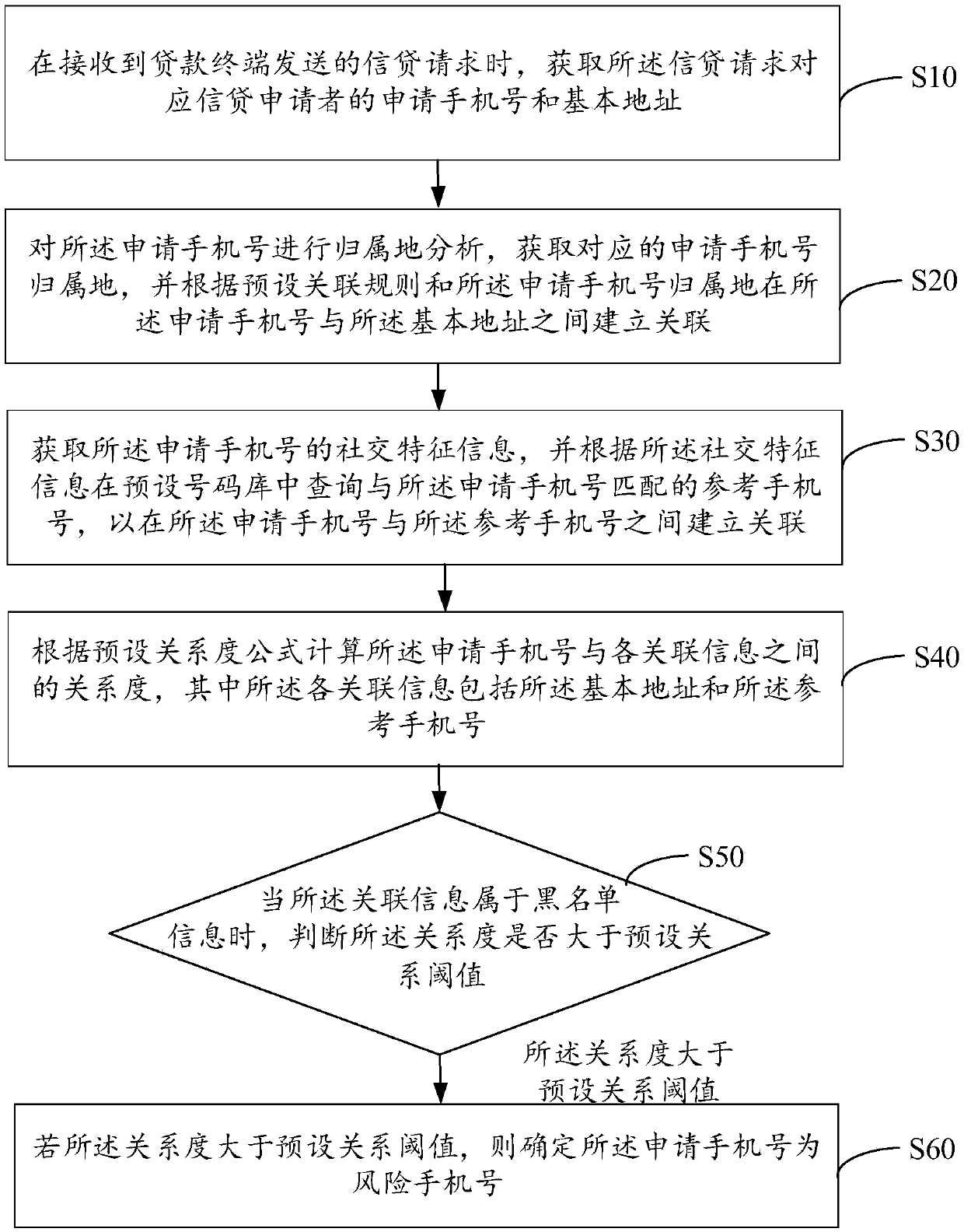

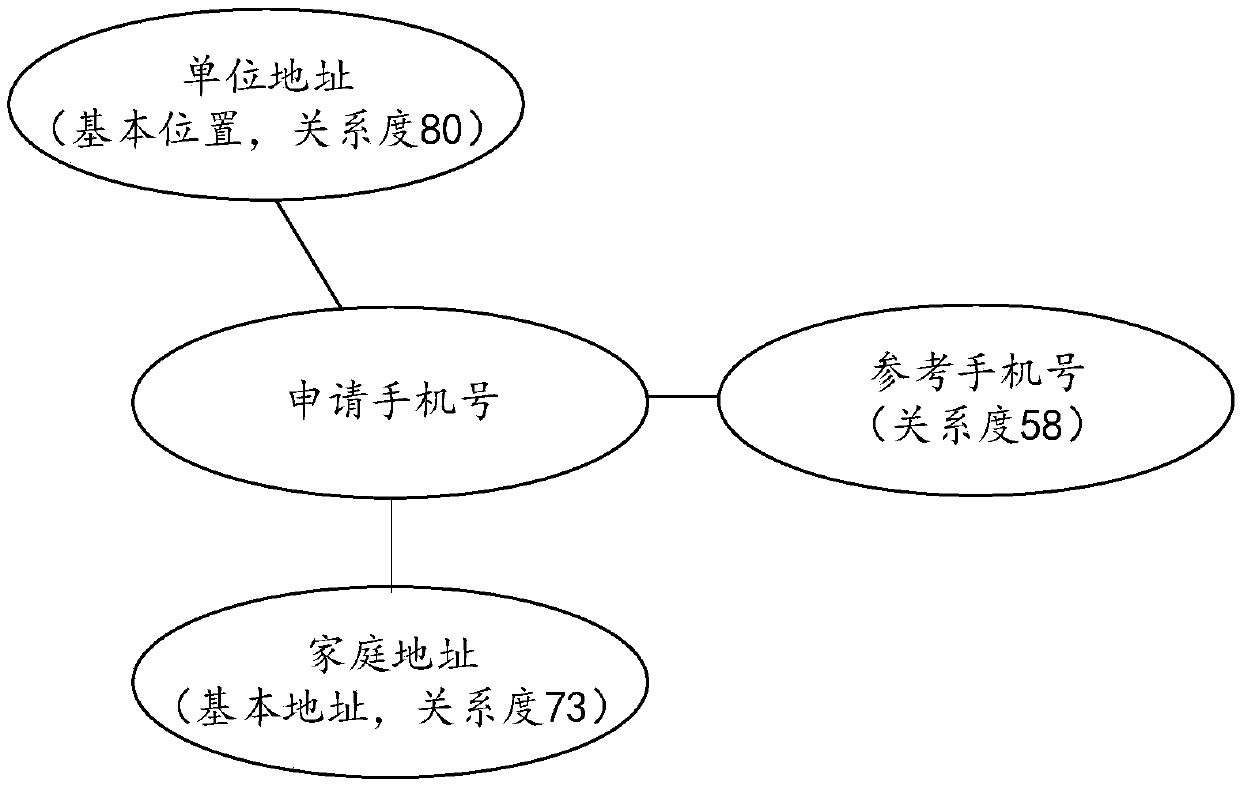

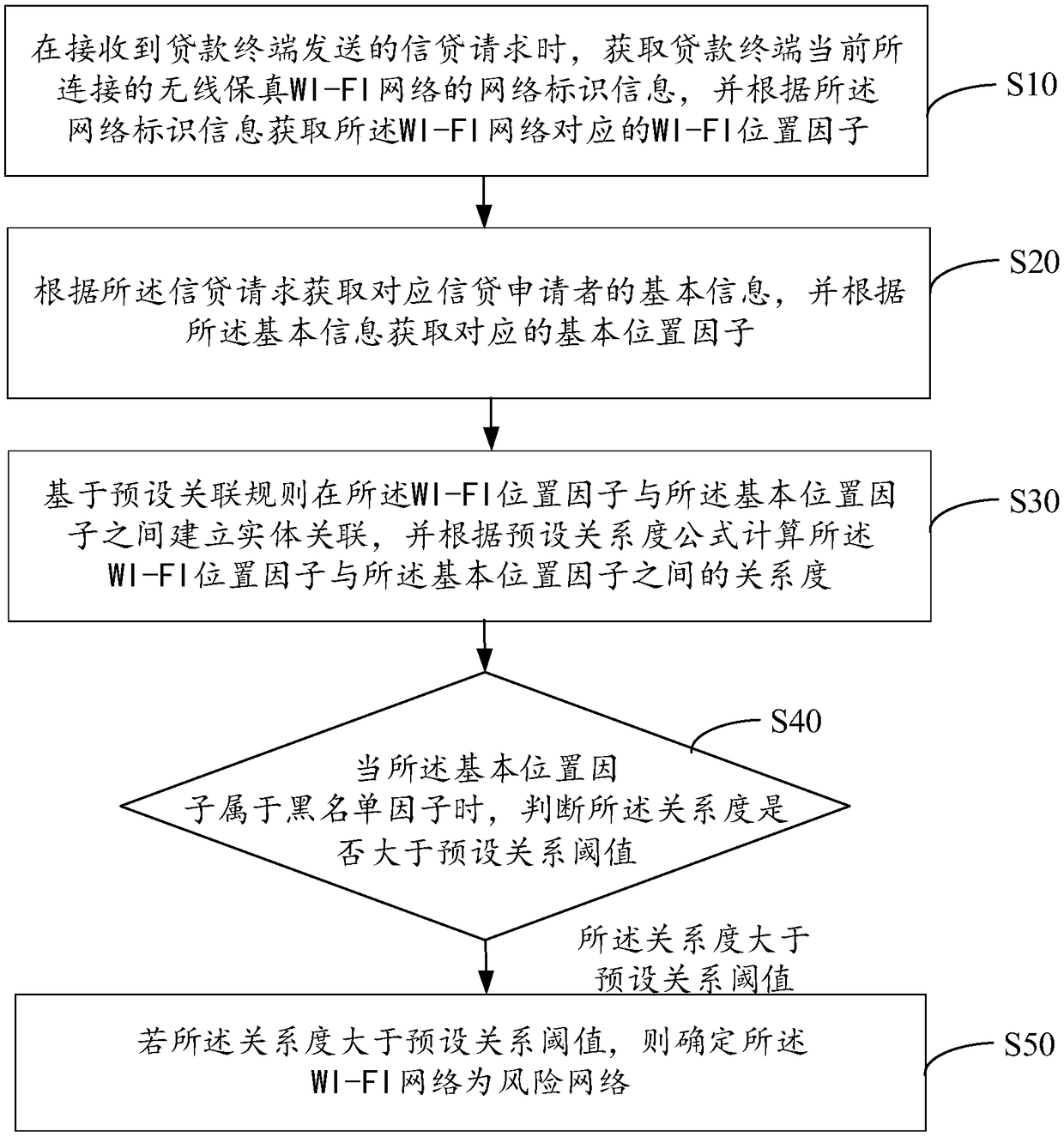

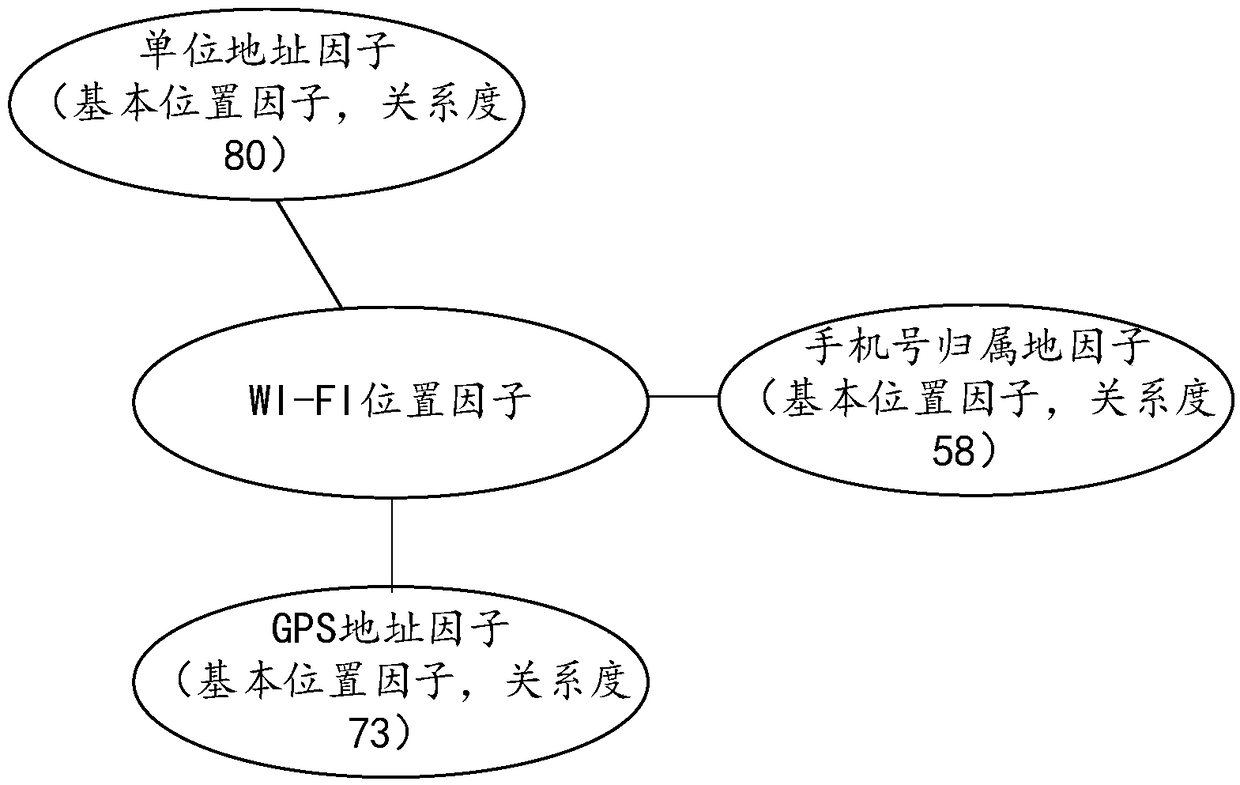

Credit fraud analysis method, device and equipment and computer readable storage medium

The invention provides a credit fraud analysis method. The invention discloses a device, equipment and a computer readable storage medium. integrating and associating multiple kinds of address information of the loan applicant in a relationmanner; the contact between the address information can be determined; the potential credit fraud risk is predicted by combining the processing logic of black (or grey) dyeing; Therefore, correlation risk detection is carried out on the loan terminal of the loan applicant in a big data analysis mode, the accuracy of credit analysis is improved, early warningcan be carried out on potential risks more effectively, the risks can be found and avoided as soon as possible, and the bad account rate is reduced.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

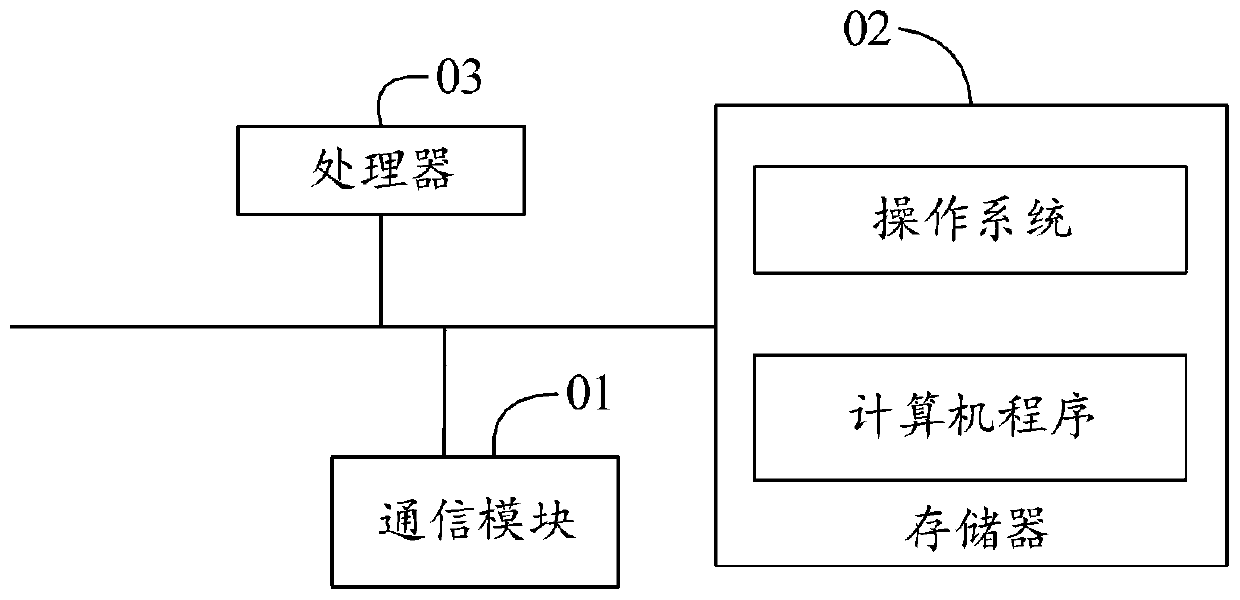

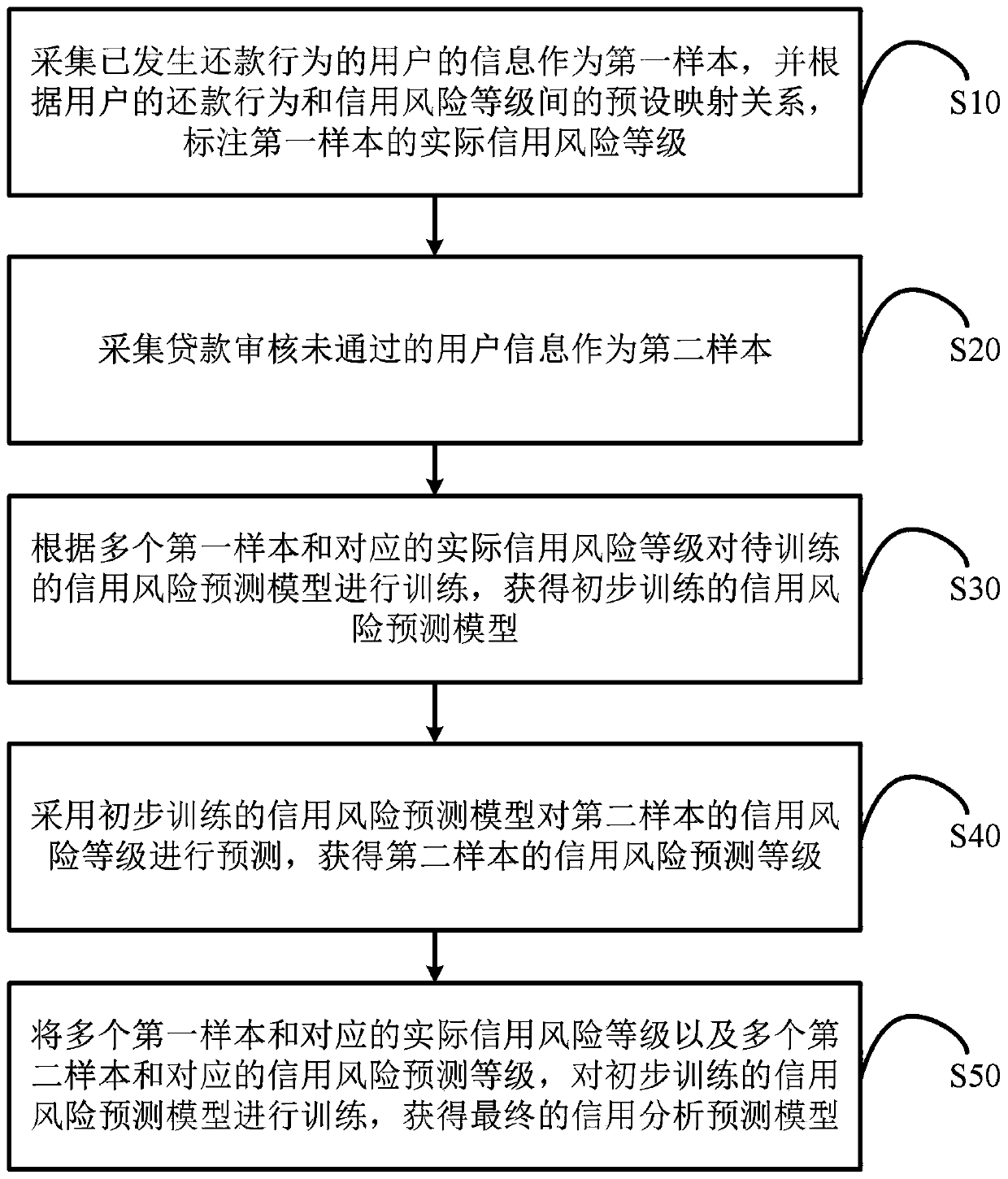

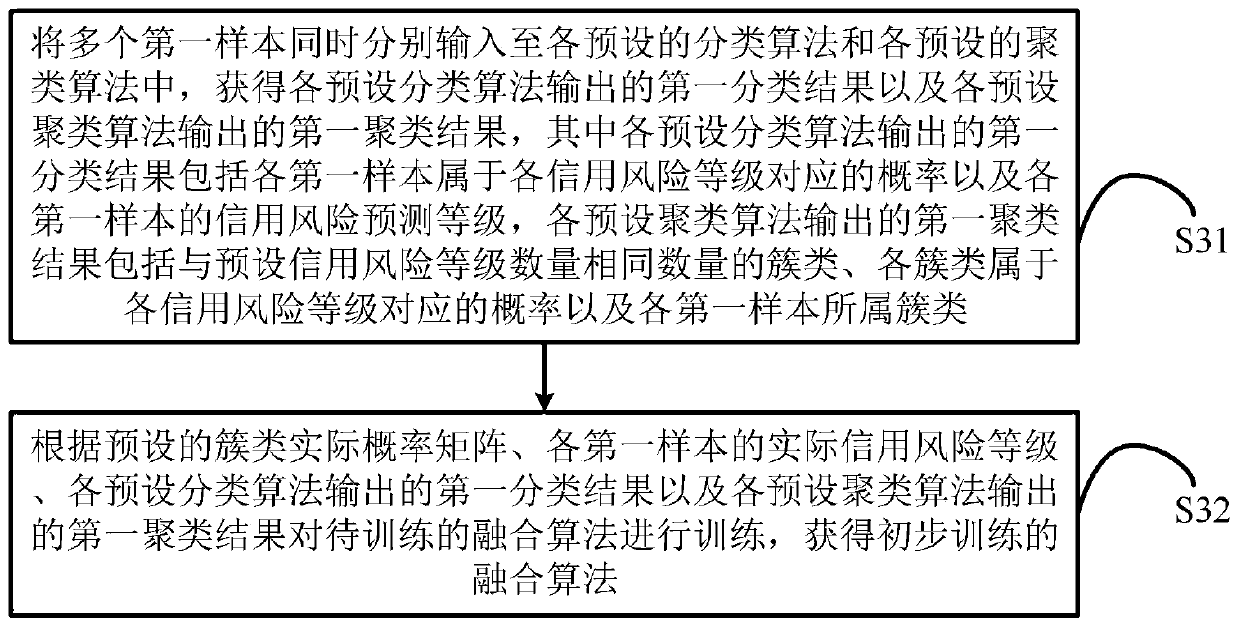

Credit risk prediction method and system, terminal and storage medium

PendingCN111062444AImprove accuracyHigh accuracy of risk predictionFinanceCharacter and pattern recognitionRisk levelData mining

The invention discloses a credit risk prediction method and system, a terminal and a storage medium, and the method comprises the steps: employing the information of a user having a repayment behaviorto train a to-be-trained credit risk prediction model, and obtaining a preliminarily trained credit risk prediction model; predicting the credit risk grades of the users who do not pass the loan audit by adopting the preliminarily trained credit risk prediction model to obtain the credit risk prediction grades of the users who do not pass the loan audit; and training the preliminarily trained credit risk prediction model according to the user information of the user with the repayment behavior, the corresponding actual credit risk level, the user information of the user with loan audit failure and the corresponding credit risk prediction level to obtain a final credit analysis prediction model. According to the invention, the problem of low accuracy of predicting the credit risk of the user in the existing credit scoring model is solved.

Owner:HUNAN UNIV

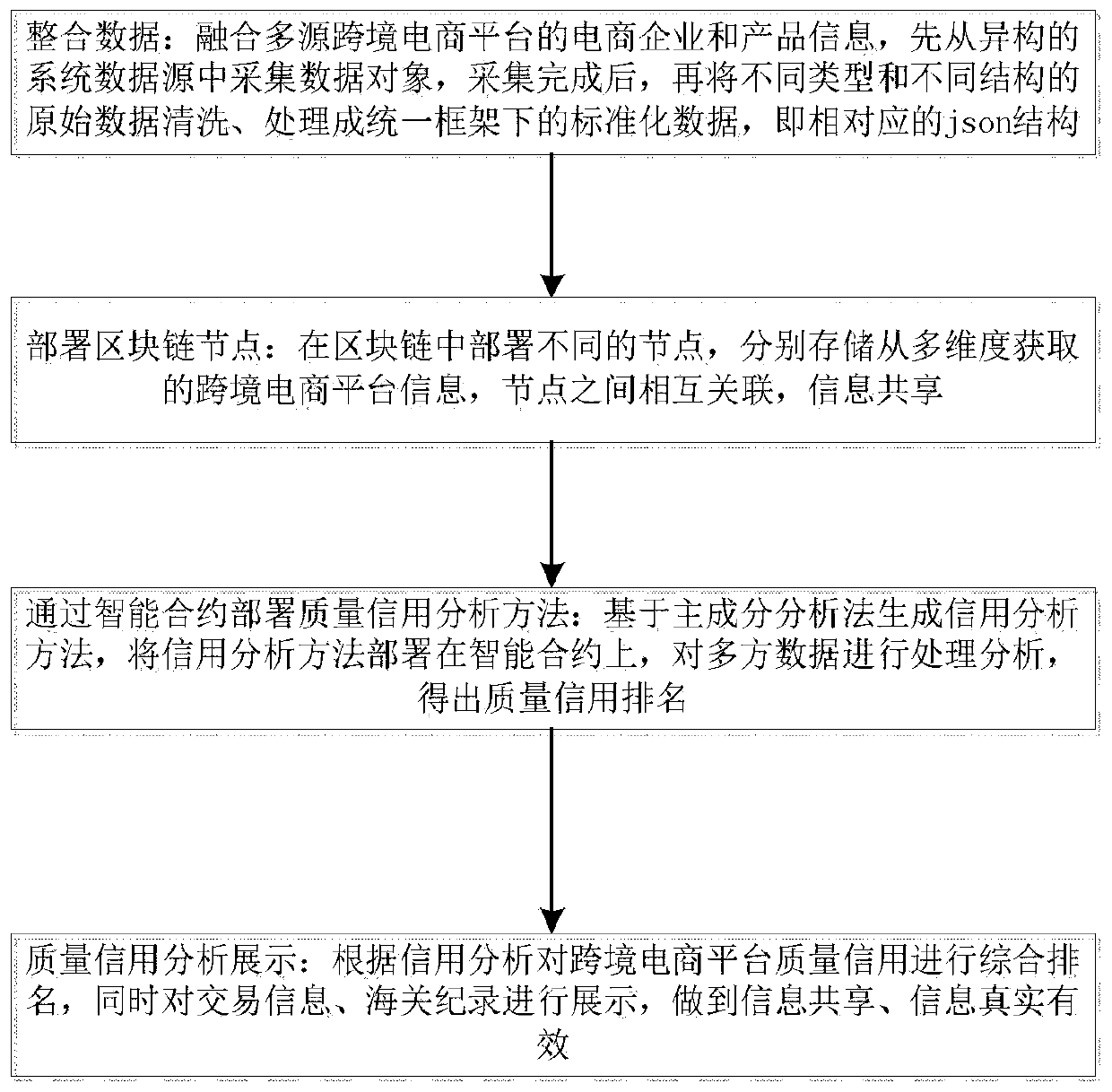

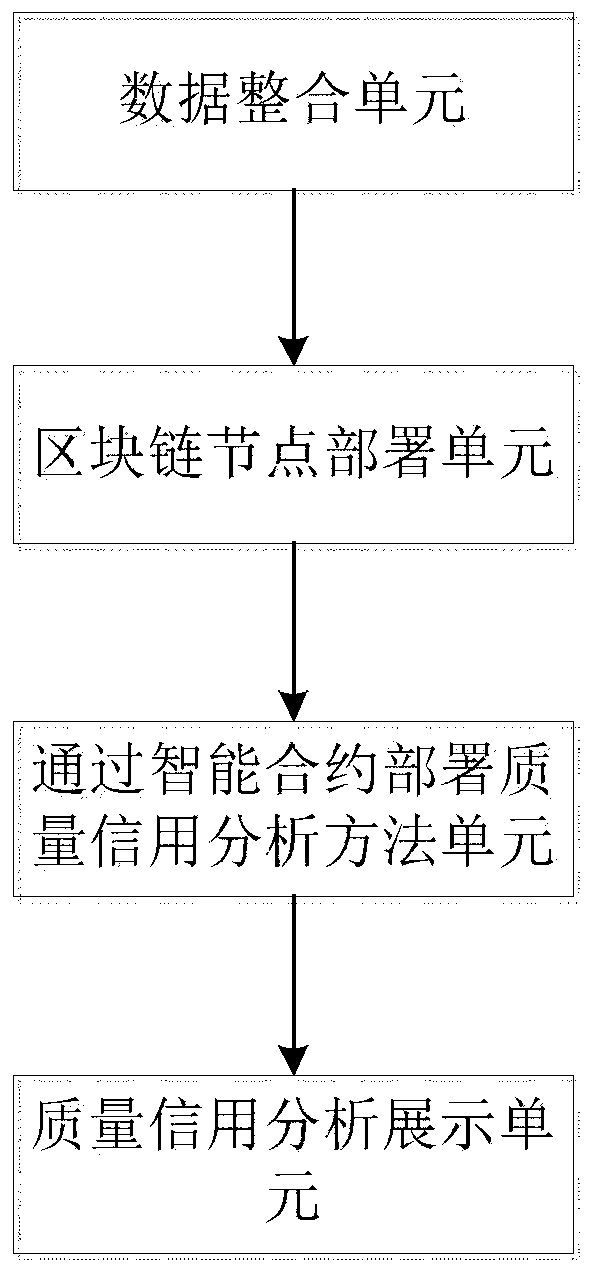

Cross-border e-commerce platform quality credit analysis method and system based on block chain

InactiveCN110599070AImprove work efficiencyReduce the phenomenon of "swiping orders"FinanceBuying/selling/leasing transactionsNODALInformation sharing

The invention discloses a cross-border e-commerce platform quality credit analysis method and system based on a block chain, belongs to the field of block chains, and aims to solve the technical problem of how to improve the working efficiency of customs, share cross-border e-commerce platform information, reduce the occurrence of a click farm phenomenon and enable consumers to buy secure and high-quality products. The technical scheme adopted by the method comprises the following steps: S1, integrating data; S2, deploying block chain nodes: deploying different nodes in the block chain, respectively storing cross-border e-commerce platform information obtained from multiple dimensions, and performing mutual association and information sharing among the nodes; s3, deploying a quality creditanalysis method through the smart contract: generating a credit analysis method based on a principal component analysis method; and S4, performing quality credit analysis and display. The system comprises a data integration unit, a block chain node deployment unit, an intelligent contract deployment quality credit analysis method unit and a quality credit analysis display unit.

Owner:山东爱城市网信息技术有限公司

Method for analyzing commercial bank credit risk based on cluster analysis

InactiveCN101350094AEasy to manageShort processing timeFinanceSpecial data processing applicationsRisk profilingAnalysis method

The invention provides a commercial bank credit analysis method based on cluster analysis, which is characterized in that the credit analysis method utilizes a novel cluster analysis method and just utilizes an order relation of customer data during a treatment process, credit customers in different grades are divided through a similar degree on attributes, thereby being convenient for the whole management of commercial banks. A clustering process is achieved through using a mathematic software, the commercial bank credit analysis method has the characteristics of short treatment time, objective method and accurate analysis results, and is particularly suitable for a credit analysis process of complex bank data.

Owner:盛秀英

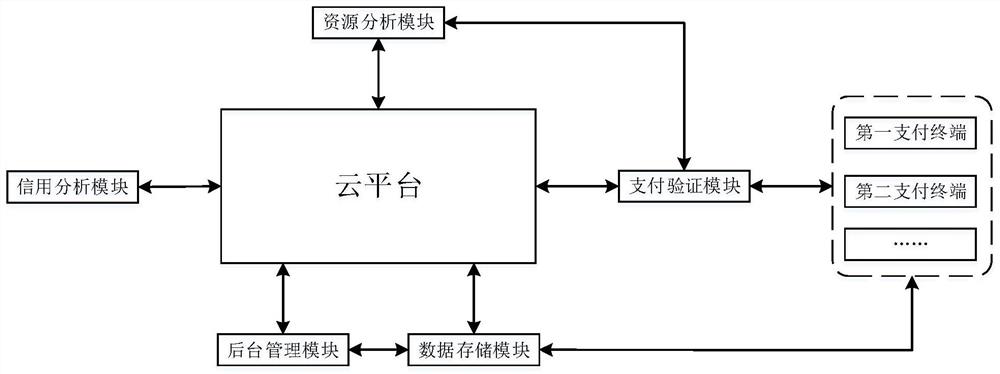

E-commerce payment system based on cloud computing

PendingCN112418839AProtection of rights and interestsGet working frequency in real timeProtocol authorisationFinancial transactionE-commerce

The invention discloses an e-commerce payment system based on cloud computing, relates to the technical field of e-commerce, and solves the technical problems that the processing capacity of a paymentterminal is insufficient and the working efficiency of the whole payment system is reduced. According to the invention, the payment terminal is arranged, and the inventory and sales volume of commodities are used as important parameters generated by the order processing sequence table, so that commodity orders with shortage of inventory can be processed preferentially, and the rights and interests of users can be protected. A resource analysis module is arranged and is used for carrying out payment verification on orders in sequence according to an order processing sequence table; the resource analysis module allocates the order processing sequence table to the payment verification module or the cloud platform according to an edge calculation principle, so that the order processing speedis improved, and the efficiency of the whole system is improved; the credit analysis module is arranged, the credit of the user is graded according to the transaction information of the user, orders are preliminarily screened, high-quality users are extracted, and the working efficiency of the system is improved.

Owner:张海燕

Big Data Credit APP Software

The invention discloses a big data credit APP software mainly comprising user information login, Detection information, credit checking and binding and data hierarchical processing, the user information login facilitates the operation of registering and authenticating login by the customer, the detection information checks the user's account name and password, The credit checking and binding is tocollect the big data information of the customer initially, and the data grading processing is to grade the credit line authority of the customer according to the big data information of the user, and the user can fill in relevant suggestions and feedback the problems encountered in the use to the background; and the credit checking and binding is to collect the big data information of the customer initially. The invention can first collect the three-dimensional information of the user's face when the user registers and logs in, and compare the collected data with the information of the boundID card picture to confirm that the user is registered and used, the safety coefficient is higher, and the big data credit analysis of the customer is more comprehensive.

Owner:安徽科讯金服科技有限公司

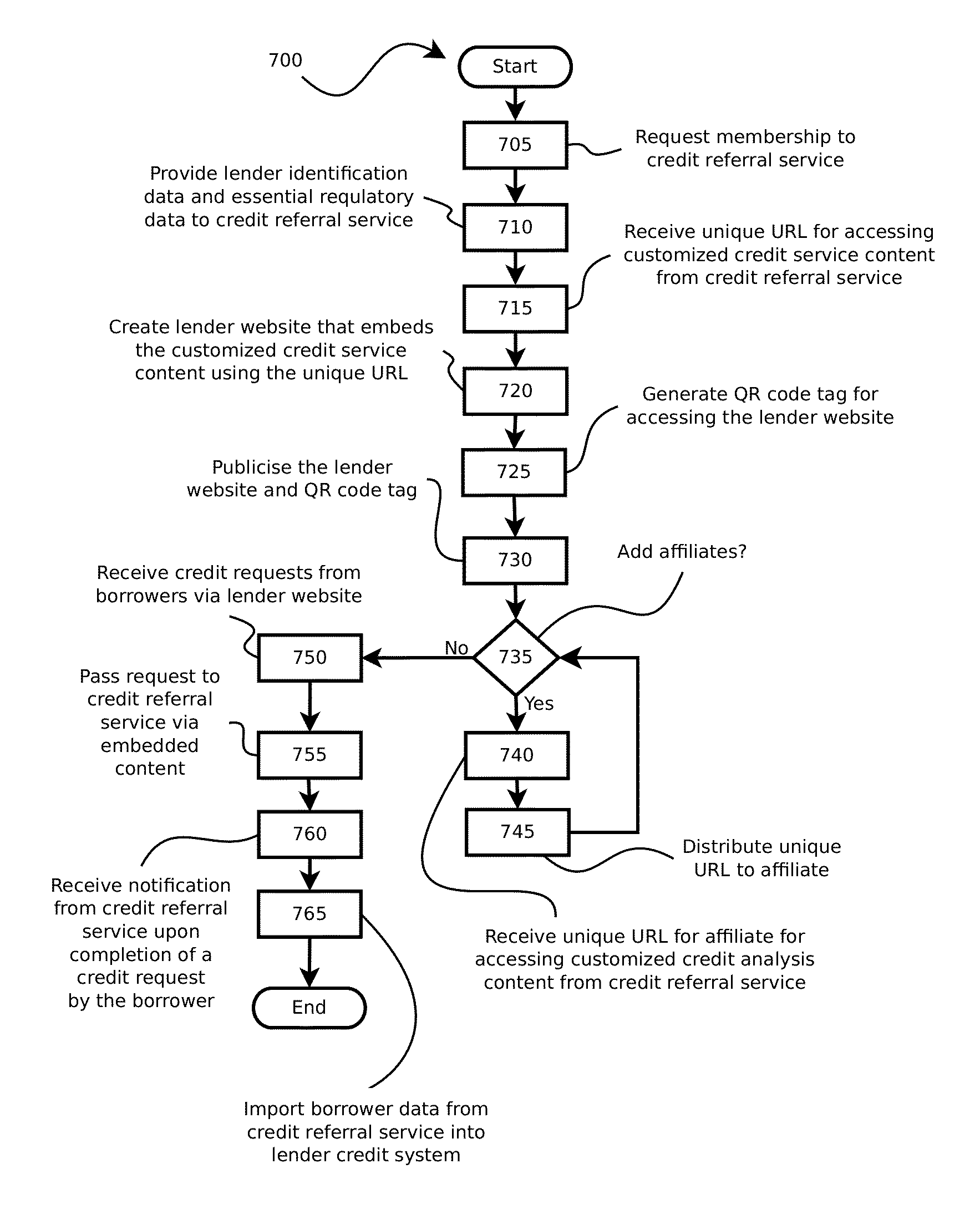

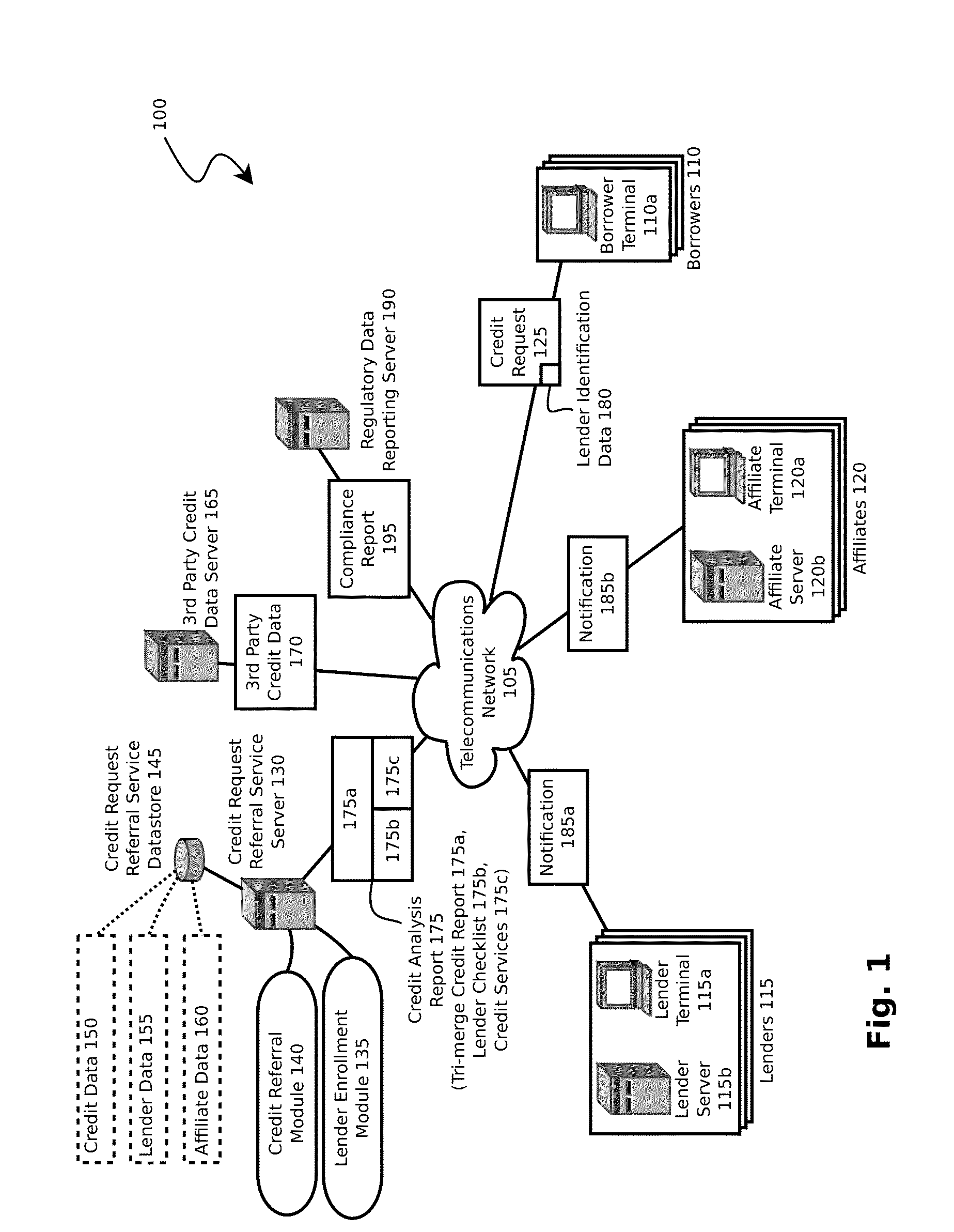

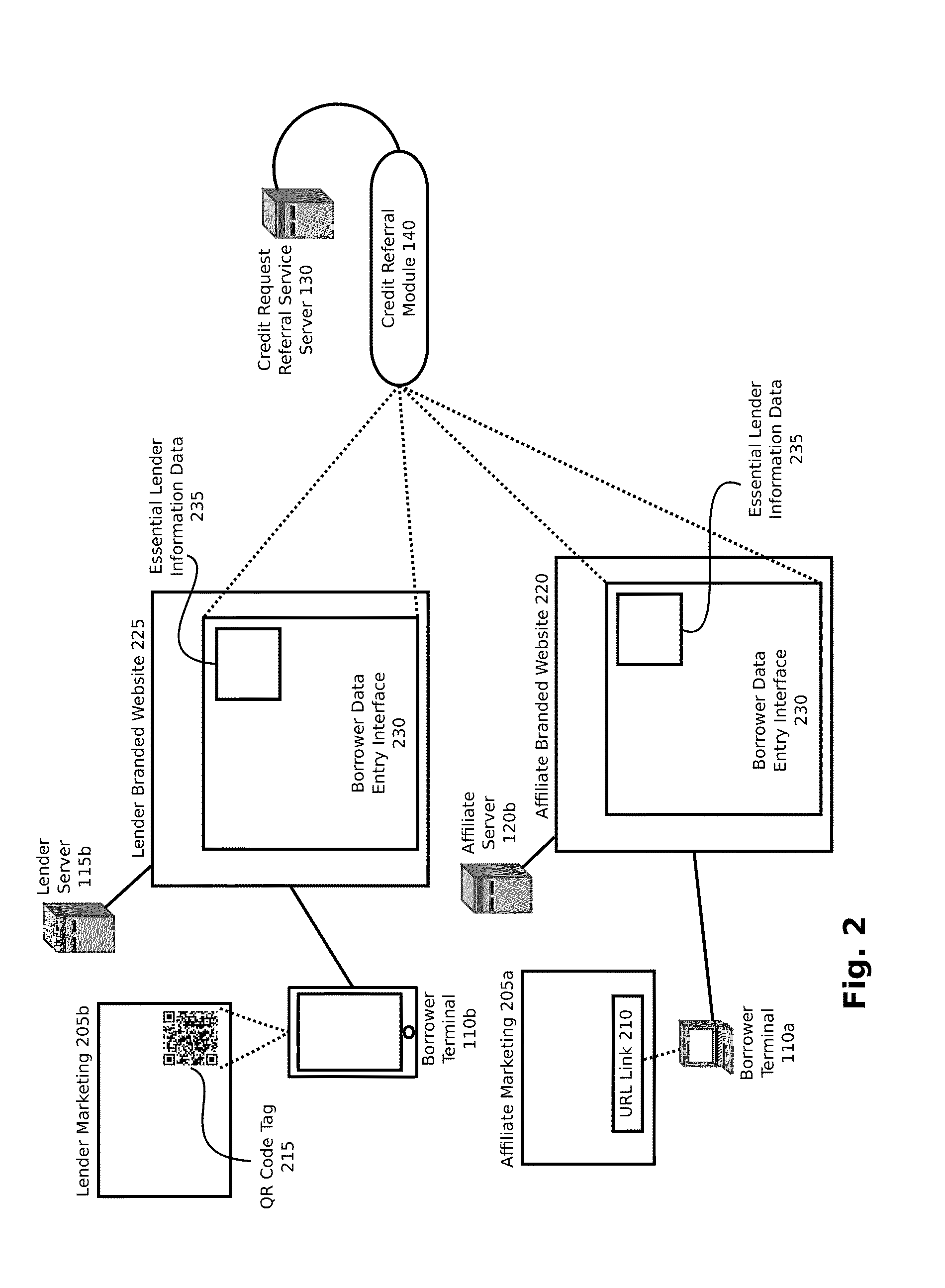

System And Method For Processing Electronic Credit Requests From Potential Borrowers On Behalf Of A Network Of Lenders And Lender Affiliates Communicating Via A Communications Network

InactiveUS20130110705A1Facilitates regulatory compliance requirementFinanceReferral serviceWorld Wide Web

A credit request referral service implements a method of processing borrower initiated electronic credit requests from potential borrowers on behalf of a network of lenders and lender affiliates communicating via a communications network. The method includes receiving a borrower initiated credit request, having lender identification data unique to a lender, on a credit referral computing device via a communications network from a borrower using a computing device and retrieving essential lender information for the lender from a database based on the lender identification data. The method further includes generating a borrower data input interface customized with preferences of the lender and displaying the essential lender information, producing a credit analysis report based on borrower data received from the borrower via the borrower data input interface, and providing notification of the borrower initiated credit request to the lender.

Owner:CONWELL III THOMAS

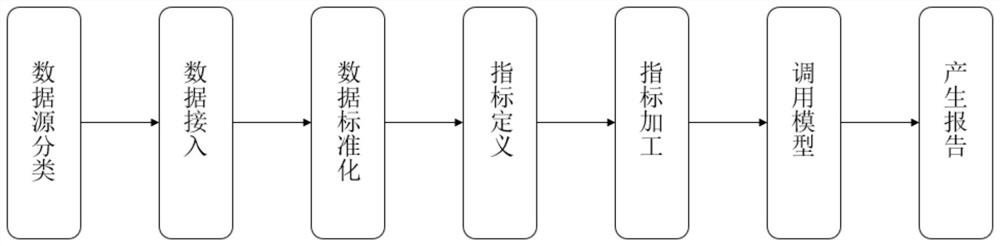

Data processing method and system based on credit report generation

PendingCN112051992AAccurate classification displayImprove robustnessFinanceText processingJavaData access

The invention discloses a data processing method and system based on credit report generation, belongs to the field of computer data processing, and aims to solve the technical problem of how to better analyze the credit of enterprises and individuals to enable credit reports to have higher robustness. The method specifically comprises the following steps: data source classification: according tothe table information of the source data, correspondingly affiliating the source data to a corresponding table in a standard table for data source classification; data access: writing a data access process based on Java, and performing data access according to an interface address and a database address provided by the data source; data standardization: standardizing the data; index definition: defining names of indexes and a processing logic; index processing: processing and encoding corresponding indexes according to the processing logic defined by the indexes; calling a model; and generating a report. The system comprises a classification unit, an access unit, a standardization unit, a definition unit, a processing unit, a calling unit and a generation unit.

Owner:天元大数据信用管理有限公司

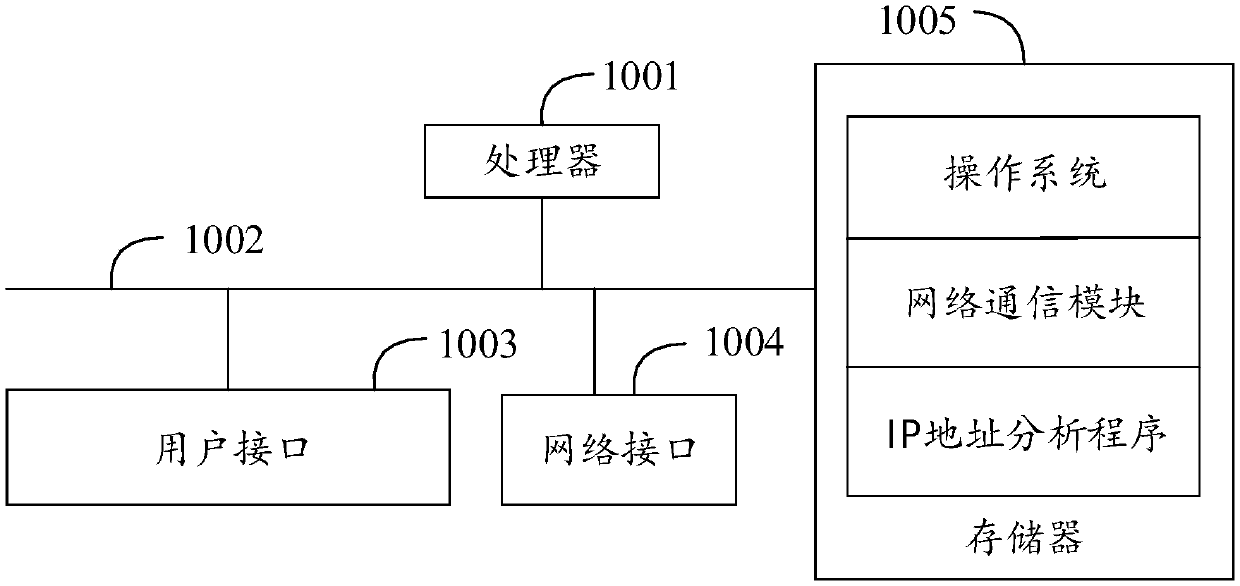

IP address analysis method and device, apparatus, and computer-readable storage medium

PendingCN109636577AEffective early warningEffective predictionFinanceTransmissionIp addressComputer terminal

The invention provides an IP address analysis method and device, an apparatus, and a computer-readable storage medium., the method includes: integrating and associating the IP address of the loan terminal with other location information of the loan applicant, thereby facilitating the identification of linkages between location information; analyzing and detecting the risk of the IP address of theloan terminal according to the processing logic of black dyeing (or gray dyeing), Thus, the potential credit fraud risk is effectively predicted in the form of big data analysis, the accuracy of credit analysis and risk assessment is improved, the potential risk can be more effectively warned, the risk can be discovered and avoided as soon as possible, the bad debt rate of loan can be reduced, andthe business safety can be improved.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

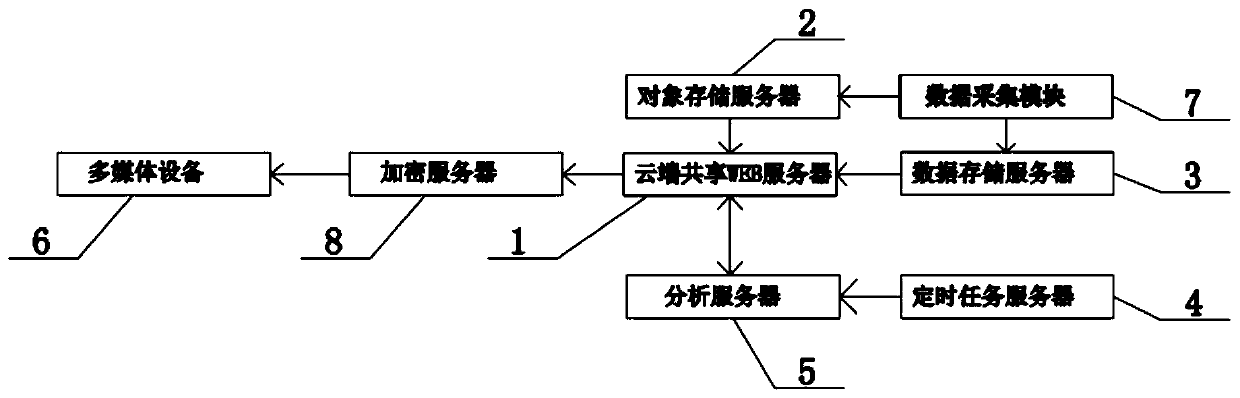

An industrial solid waste supervision subject credit evaluation system

PendingCN109948939ASolve the problem of single means of solid waste managementIncrease motivationResourcesCommerceAnalysis dataWeb service

The invention discloses an industrial solid waste supervision subject credit evaluation system. The system comprises a cloud shared WEB server, an object storage server, a data storage server, a timing task server, an analysis server and an encryption server, the cloud shared WEB server is used for data uploading and pushing, and the object storage server is used for data storage; the data storageserver is used for storing valuable data to form an analysis data pool; the timed task server is used for regularly referring to an evaluation standard customized by the environmental protection agency; and the analysis server is used for carrying out credit analysis and subject ranking on the data. The method has the advantage of solving the problem of single solid waste treatment means of the environmental protection agency, and is mainly used for solid waste supervision.

Owner:江苏赛清科技有限公司 +1

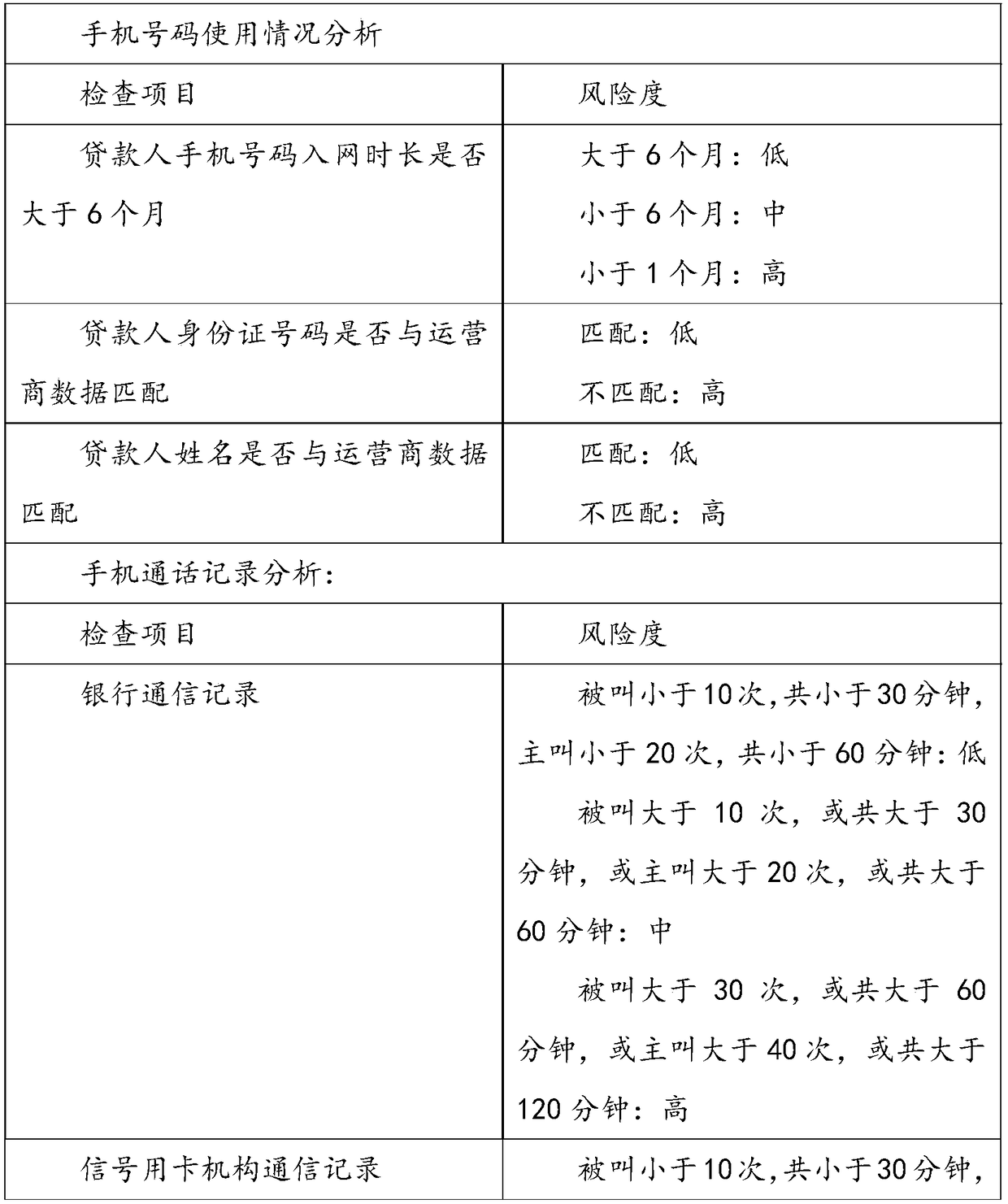

A risk analysis method and device of a mobile phone number, an apparatus and a readable storage medium

PendingCN109636570AReduce bad debt rateImprove accuracyFinanceCharacter and pattern recognitionRisk profilingAnalysis method

The invention provides a risk analysis method and device of a mobile phone number, an apparatus and a readable storage medium. The mobile phone number of a loan applicant is integrated and associatedwith other information (including the information of the loan applicant and the information of others) in a relationship mode, which is conducive to determining the connection between the mobile phonenumber and other information. the method analyzes and detects the risk of the application mobile phone number according to the processing logic of black dyeing (or gray dyeing), Thus, the potential credit fraud risk is effectively predicted in the way of big data analysis, the accuracy of credit analysis is improved, the potential risk can be more effectively warned, the risk can be discovered and avoided as soon as possible, and the bad debt ratio of loan can be reduced.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

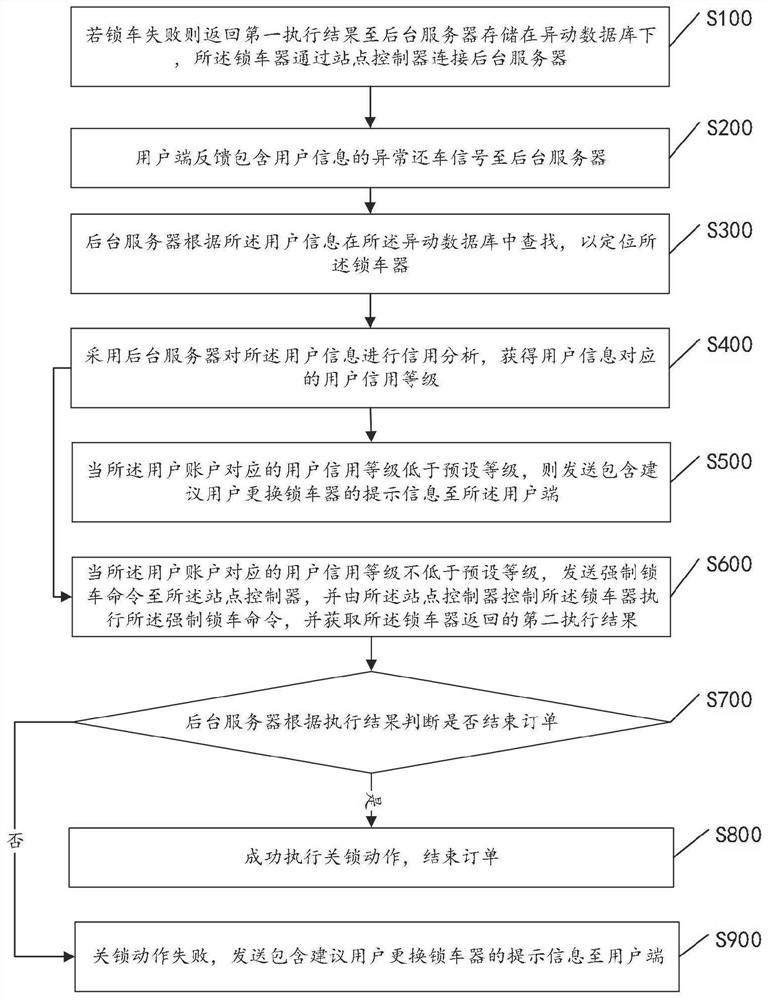

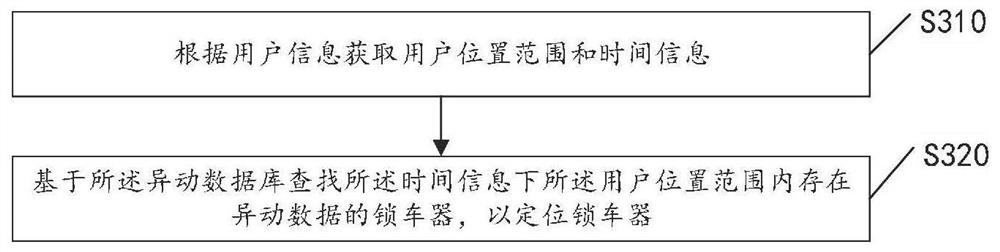

Public bicycle abnormal returning processing method and system

ActiveCN113284296ASolve travel problemsSettlement feeApparatus for meter-controlled dispensingIndividual entry/exit registersOperations researchData bank

The invention provides a public bicycle abnormal returning processing method and system, relates to the technical field of bicycle management, and is applied to the public bicycle; the method comprises the steps: the public bicycle enters a bicycle locking device, a bicycle locking command is executed, a first execution result is returned to a background server and the first execution result is stored in a transaction database if the bicycle locking fails, the bicycle locking device is connected with the background server through a station controller, and a user side feeds back an abnormal bicycle returning request to the background server; the background server locates the bicycle locking device according to the user information and performs credit analysis on the user information to obtain a user credit rating; when the user credit level corresponding to a user account is not lower than the preset level, a forced vehicle locking command is sent, the vehicle locking device is controlled to execute the forced vehicle locking command, and a second execution result returned by the vehicle locking device is obtained; the background server judges whether to end the order according to the second execution result; if the locking action is successful, the order is ended; and if the locking action fails, prompt information for suggesting the user to replace the bicycle locking device is sent to the user side, and the problem that a bicycle cannot be locked when an abnormal condition occurs when the user uses the public bicycle and returns the bicycle at present is solved.

Owner:YOUON TECH CO LTD

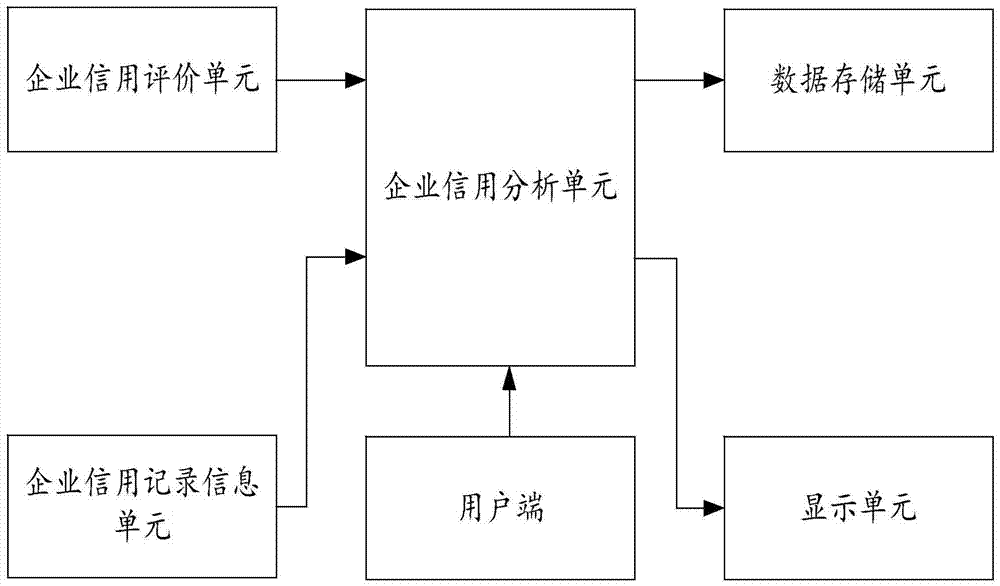

Enterprise credit evaluation system

InactiveCN105447650ARealize evaluation analysisEasy to analyzeResourcesBusiness-to-businessEvaluation system

The invention discloses an enterprise credit evaluation system. The system comprises an enterprise credit evaluation unit, an enterprise credit record information unit, an enterprise credit analysis unit, a data storage unit, a user side and a display unit, wherein the enterprise credit evaluation unit comprises an enterprise credit evaluation setting unit, an enterprise project credit evaluation unit and an enterprise benefit evaluation unit; the enterprise credit evaluation, the enterprise credit record information unit, the data storage unit, the user side and the display unit are respectively connected with the enterprise credit analysis unit; and the enterprise credit evaluation, the enterprise credit record information unit and the enterprise credit analysis unit are respectively connected with the data storage unit. The enterprise credit evaluation system has the benefits of realizing the evaluation analysis of the enterprise credit, facilitating the analysis from the external enterprises to the enterprise and improving the opportunity of high investment.

Owner:WUHU LERUISI INFORMATION CONSULTING

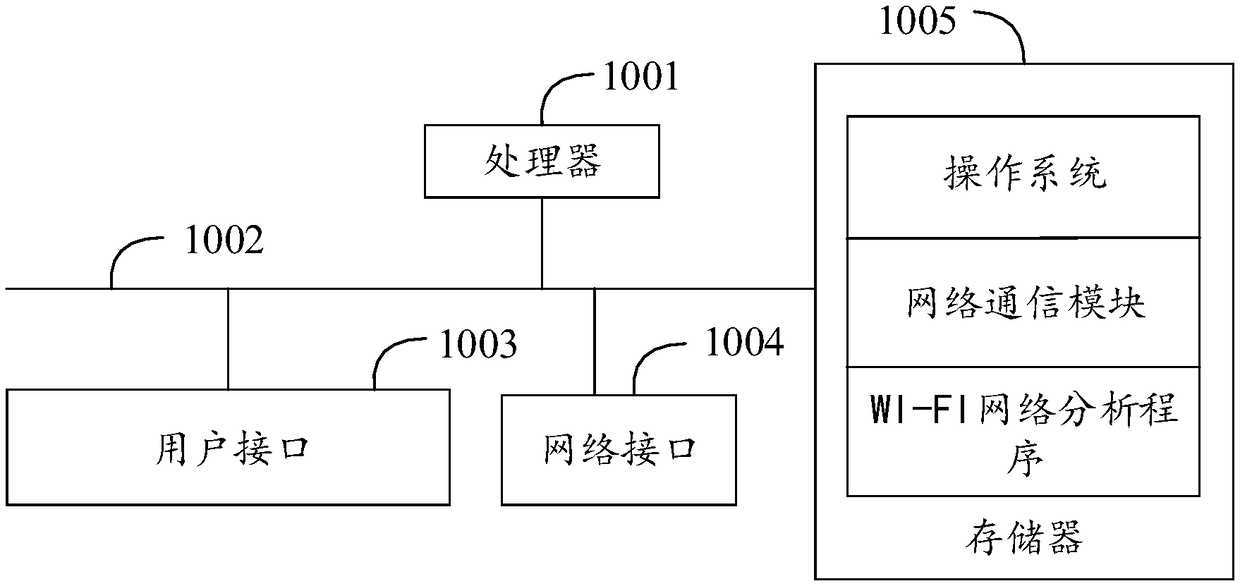

Method, device and equipment for analyzing WI-FI network, as well as readable storage medium

ActiveCN109413687AReduce bad debt rateEffective predictionLocation information based serviceSecurity arrangementWi-FiAnalysis method

The present invention provides a method, a device and equipment for analyzing a WI-FI network, as well as a readable storage medium. The method, the device and the equipment of the invention have thebeneficial effects that: integration and association are performed on a WI-FI network connected by a loan terminal and other position information of a loan applicant, thereby facilitating determination of association among position information, in addition, analysis and detection are performed on the risk of the WI-FI network connected by the loan terminal through combination of a blackening (or graying) processing logic, so as to effectively predict a potential credit fraud risk in the form of big data analysis, thereby improving accuracy of credit analysis, and benefiting reduction of a credit bad debt rate.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

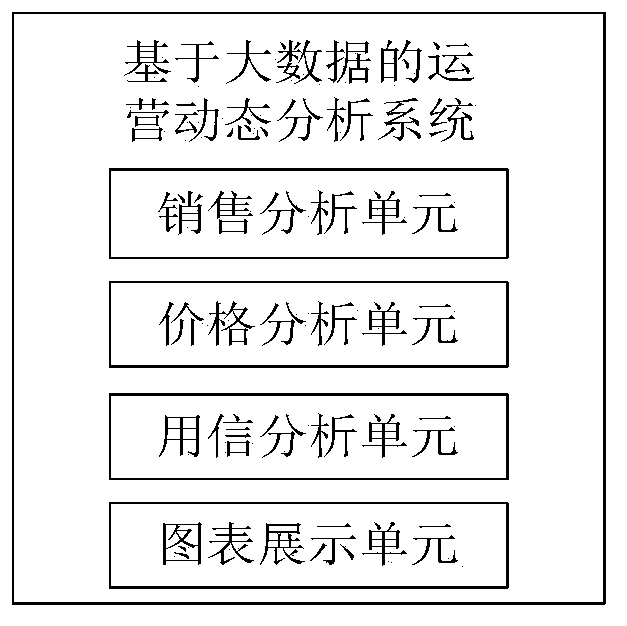

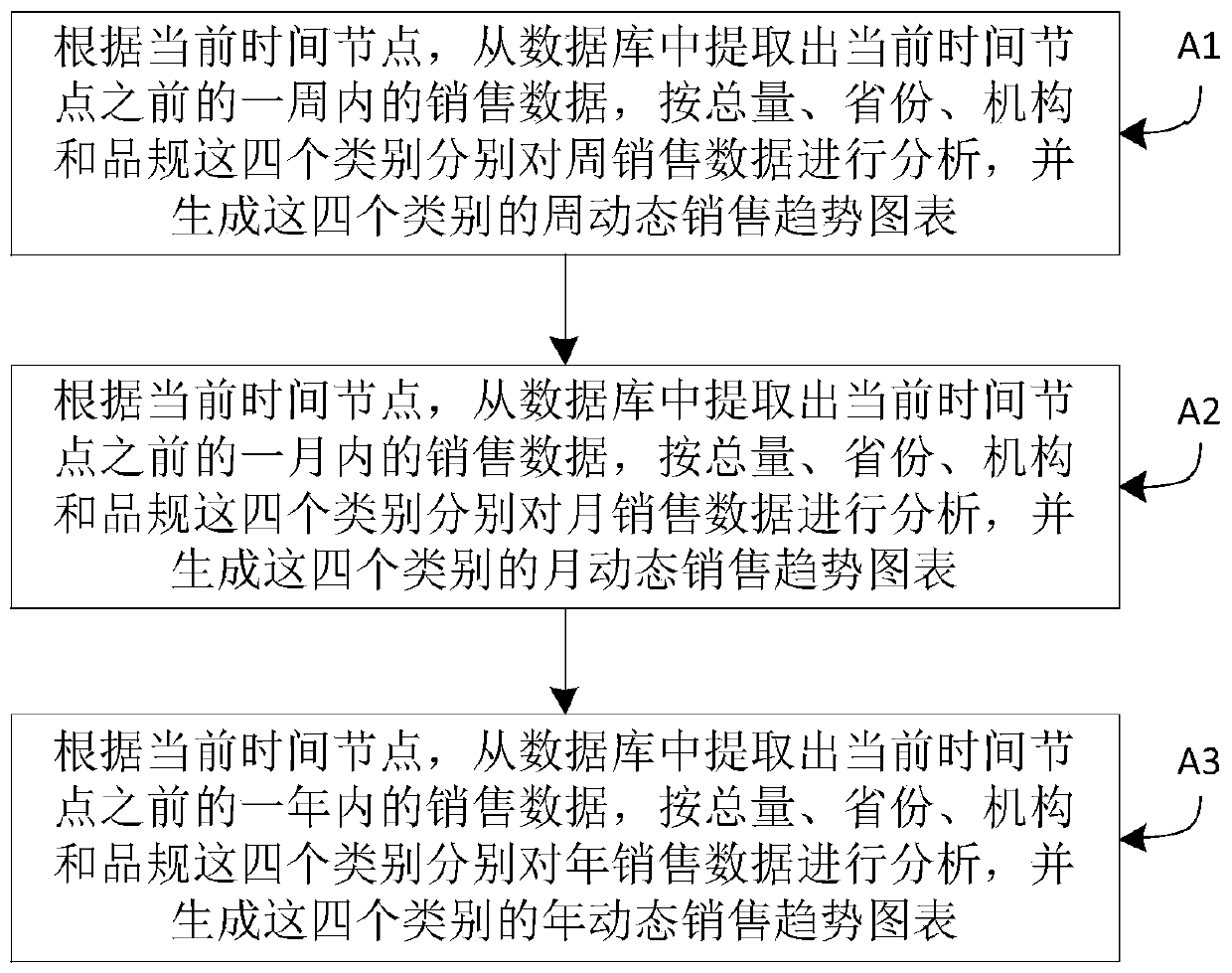

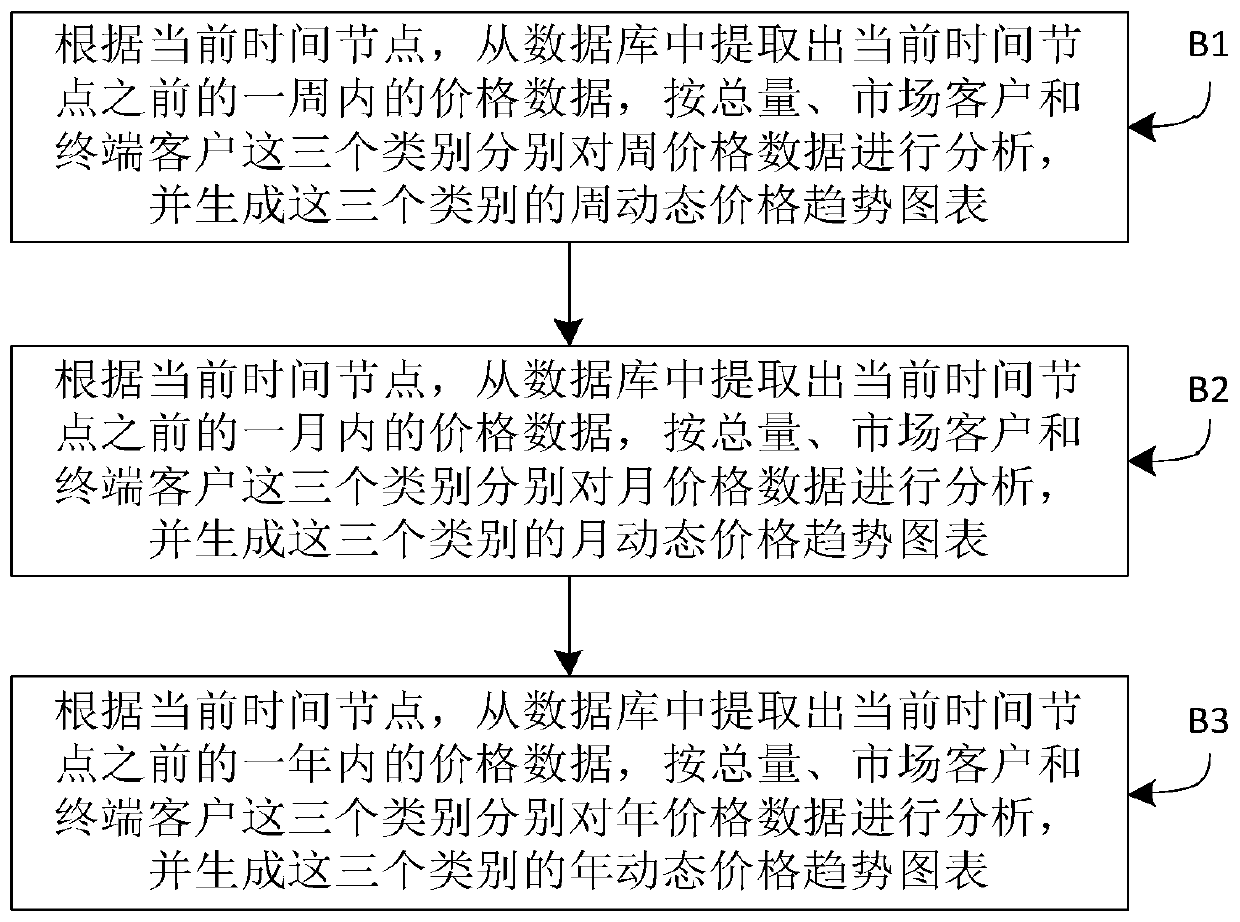

Operation dynamic analysis system and method based on big data

The invention belongs to the technical field of Internet computers, and particularly relates to an operation dynamic analysis system and method based on big data, wherein the system comprises a salesvolume analysis unit which is used for carrying out the dynamic sales analysis of different dimensions of weekly and monthly years of sales data, and generating a weekly and monthly year sales trend chart before a current time node; the price analysis unit is used for carrying out dynamic price analysis of different dimensions of weekly and monthly years on the product price data and generating aweekly and monthly year price trend chart before the current time node; the credit analysis unit is used for carrying out credit analysis according to the loan amount and the sales amount and generating a weekly and monthly credit chart before the current time node; and the chart display unit is used for displaying the sales trend chart, the price trend chart and the credit chart. According to theinvention, the annual sales price change of weeks and months before the current time point of an enterprise can be dynamically analyzed; and moreover, the credit of the loan enterprise can be analyzed, and the loan risk is early warned and reminded in the form of a credit chart.

Owner:大汉电子商务有限公司

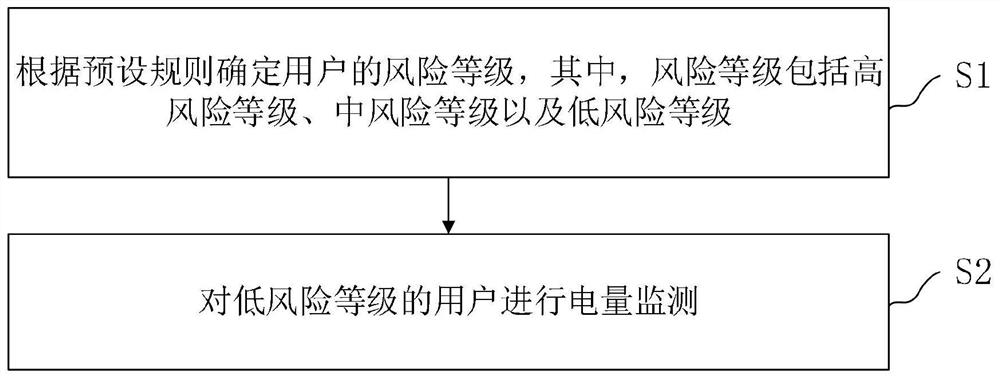

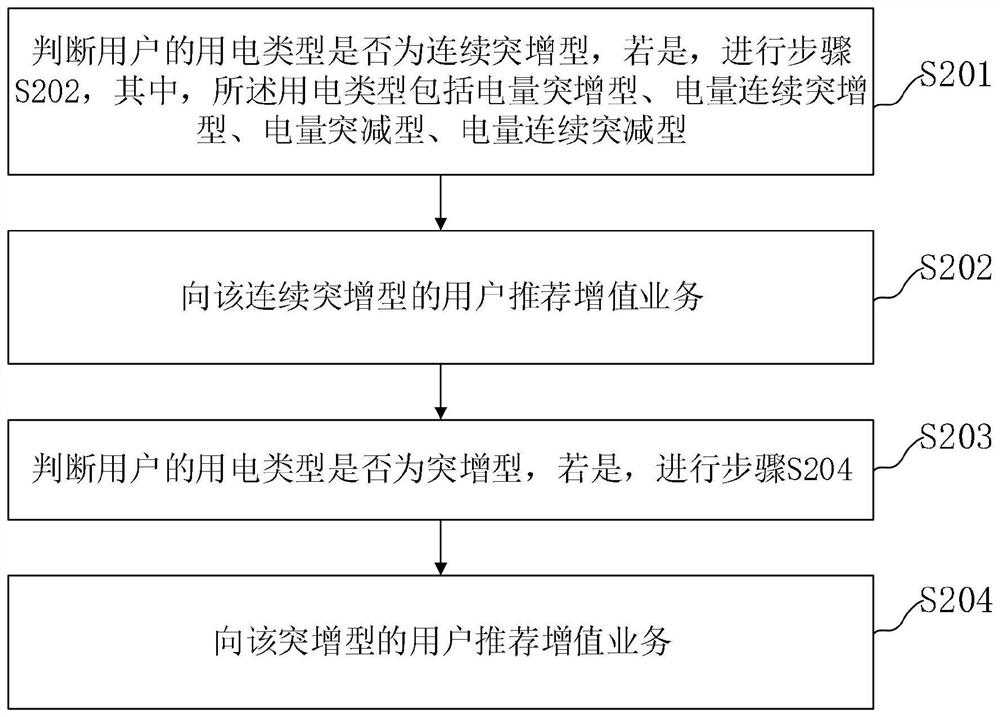

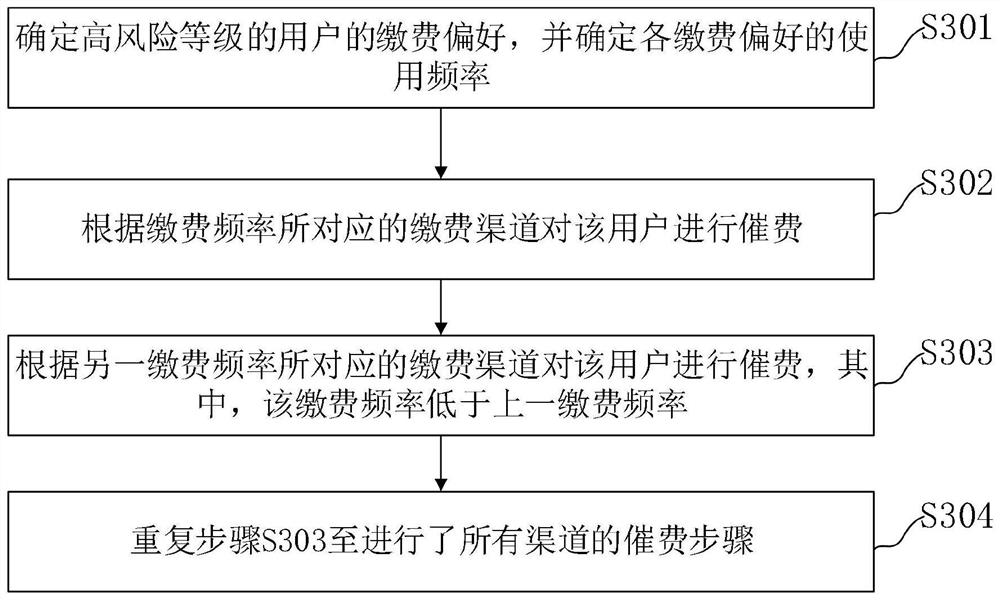

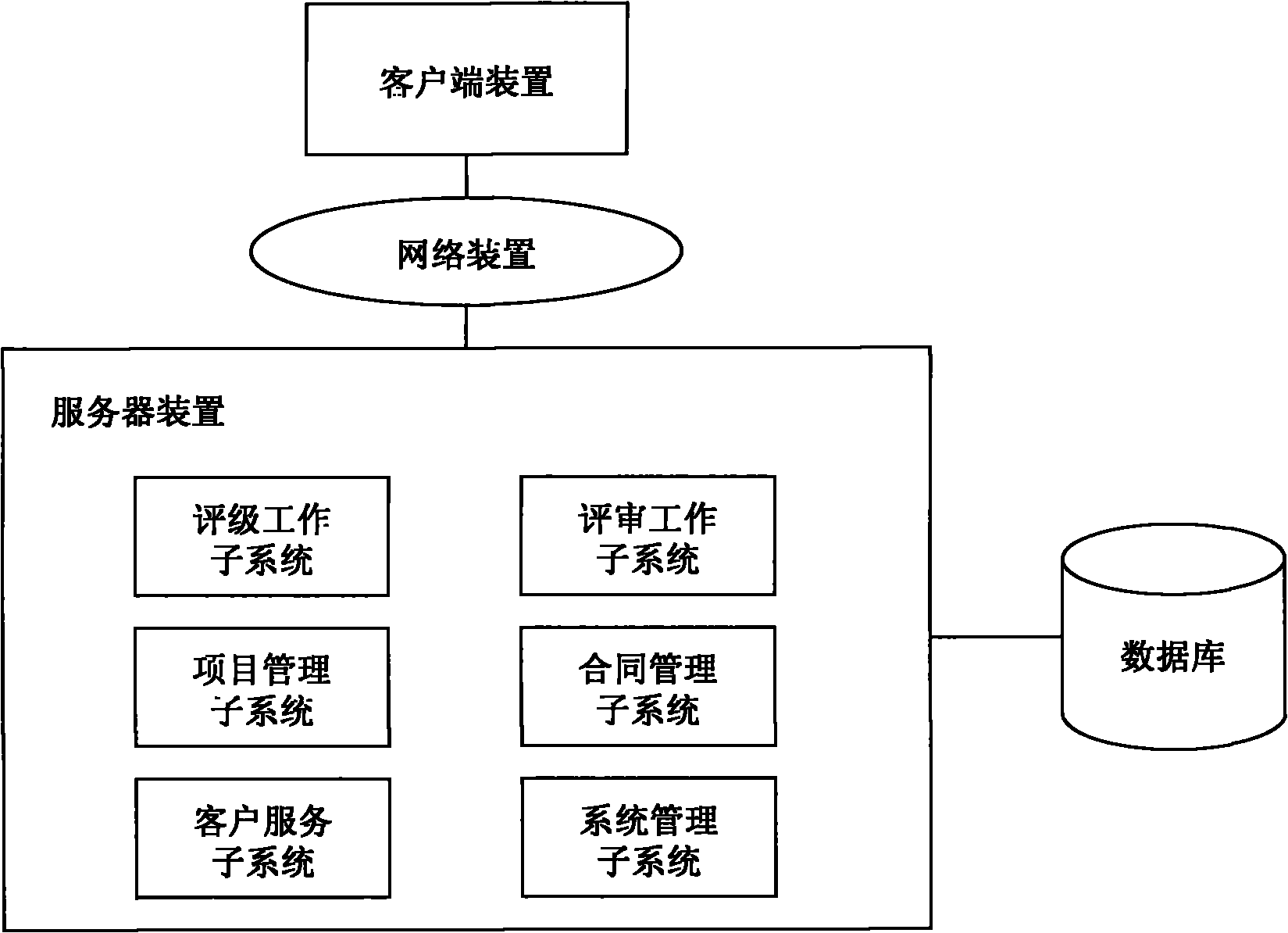

Electric charge recovery risk prevention and control method based on risk level

The invention discloses an electric charge recovery risk prevention and control method based on risk levels. The method comprises the steps: determining the risk levels of a user according to a preset rule, and enabling the risk levels to comprise a high risk level, a medium risk level and a low risk level; and electric quantity monitoring is carried out on the low-risk-level users. An electricity charge risk evaluation model and an application function are constructed based on data such as customer electricity utilization direct behaviors and associated behaviors, customer credit analysis, electricity utilization trend analysis, industry foreground information evaluation and emergency evaluation are carried out by means of methods such as service personnel investigation and survey, basic interviews and rule induction, Meanwhile, a data mining algorithm is adopted to establish an electricity charge risk evaluation model and an application function. Factual risk customers and potential risk customers are calculated and outputted.

Owner:SHANGHAI MUNICIPAL ELECTRIC POWER CO

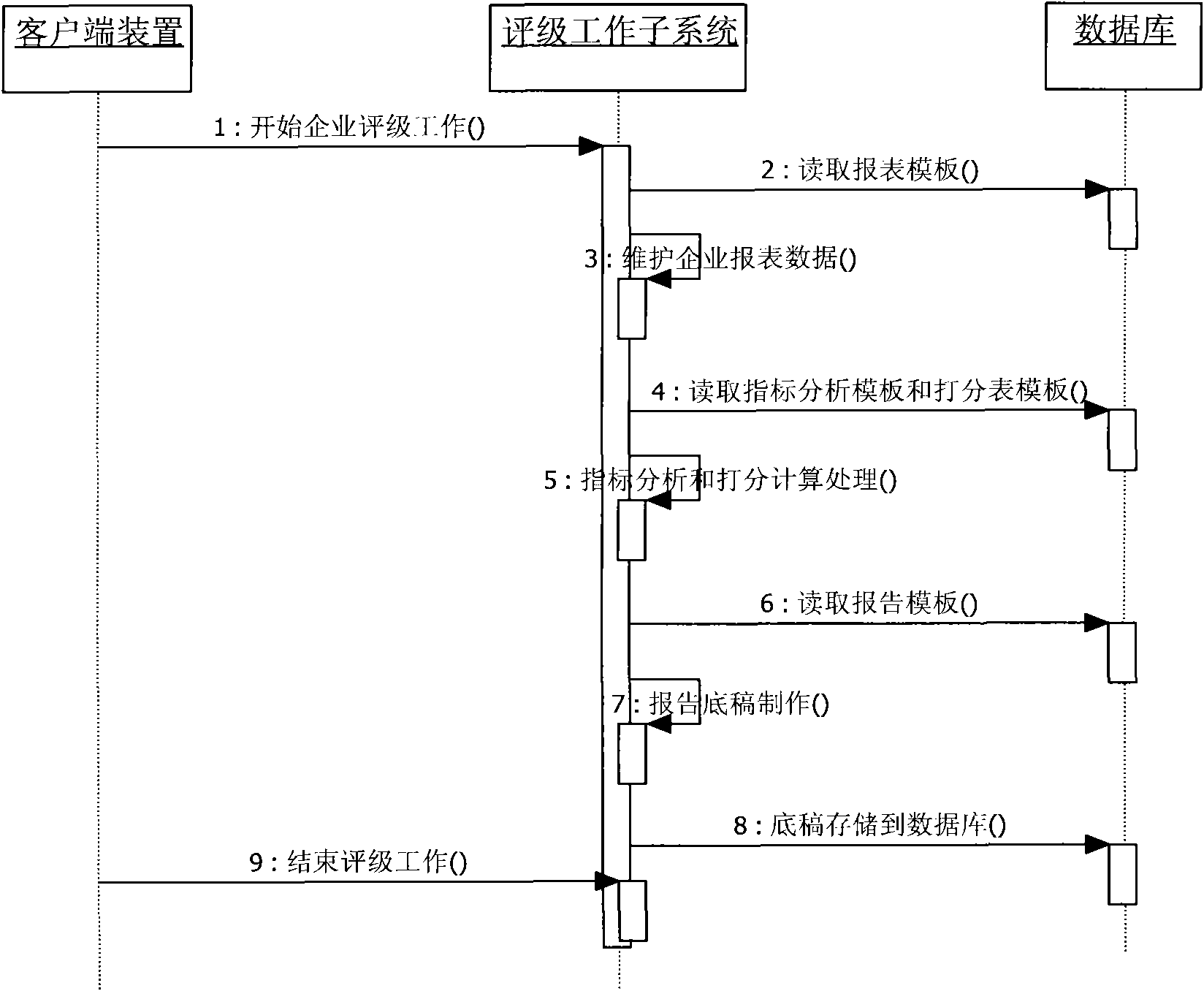

Integrated method for rating working environment based on credit rating system

InactiveCN102013079AEasy data maintenanceFinanceTransmissionWorking environmentIntegrated operations

The invention provides an advanced integrated method for rating working environment based on a credit rating system. In the method, integrated operation of information maintenance, data analysis and manuscript production are selectively performed by the credit rating system. The method has the advantages that: an integrated working environment is provided for a rating analyst of a system user, and a plurality of tools related to credit analysis work is provided in a uniform interface, so that the analyst can conveniently perform operation such as data maintenance, index analysis, calculation grading, adjustment grading, rating, report manuscript production and the like.

Owner:苏州德融嘉信信用管理技术股份有限公司

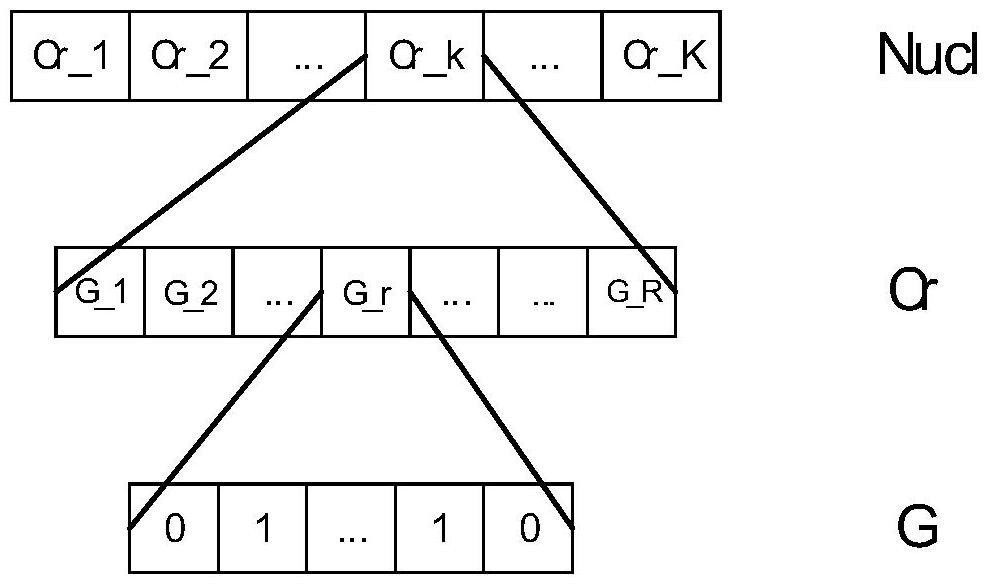

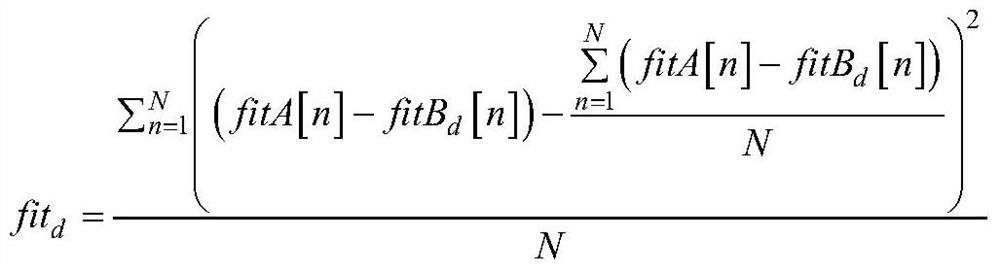

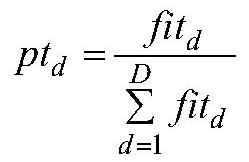

A supply chain financial credit analysis method based on multi-layer genetic method under the background of big data

ActiveCN106469411BImprove analysisSpeed up the calculation processFinanceGenetic modelsLocal optimumAlgorithm

The invention discloses a supply chain financial credit analysis method based on a multi-layer genetic method under the background of big data. The invention designs a data classification method to perform fuzzy processing on it, effectively speeding up the computer's analysis and calculation of data; at the same time , in the coding stage, this embodiment divides the supply chain data into three layers according to the characteristics, and each layer designs a corresponding crossover method. As the genetic segment at the bottom layer, this embodiment designs random intersection points to meet the diversity of the population; as the chromosome at the middle layer, it plays a vital role in finding the local optimal solution, so this embodiment uses the golden section method to design Fixed intersection points, while avoiding the interaction between different types of data; as the top layer of the nucleus, the purpose of the intersection is to gather chromosomes with high fitness into one chromosome, speed up the evolution of the nucleus, and improve the convergence speed of the method.

Owner:湖南衍金征信数据服务有限公司

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com