Credit eligibility assessment method and system for obtaining credit data online and storage medium

A data storage module and data technology, applied in data processing applications, instruments, finance, etc., can solve the problems of lenders leaking, personal information cannot be effectively protected, tampered with, forged, etc., to reduce workload and avoid being Effects of tampering and improving security

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

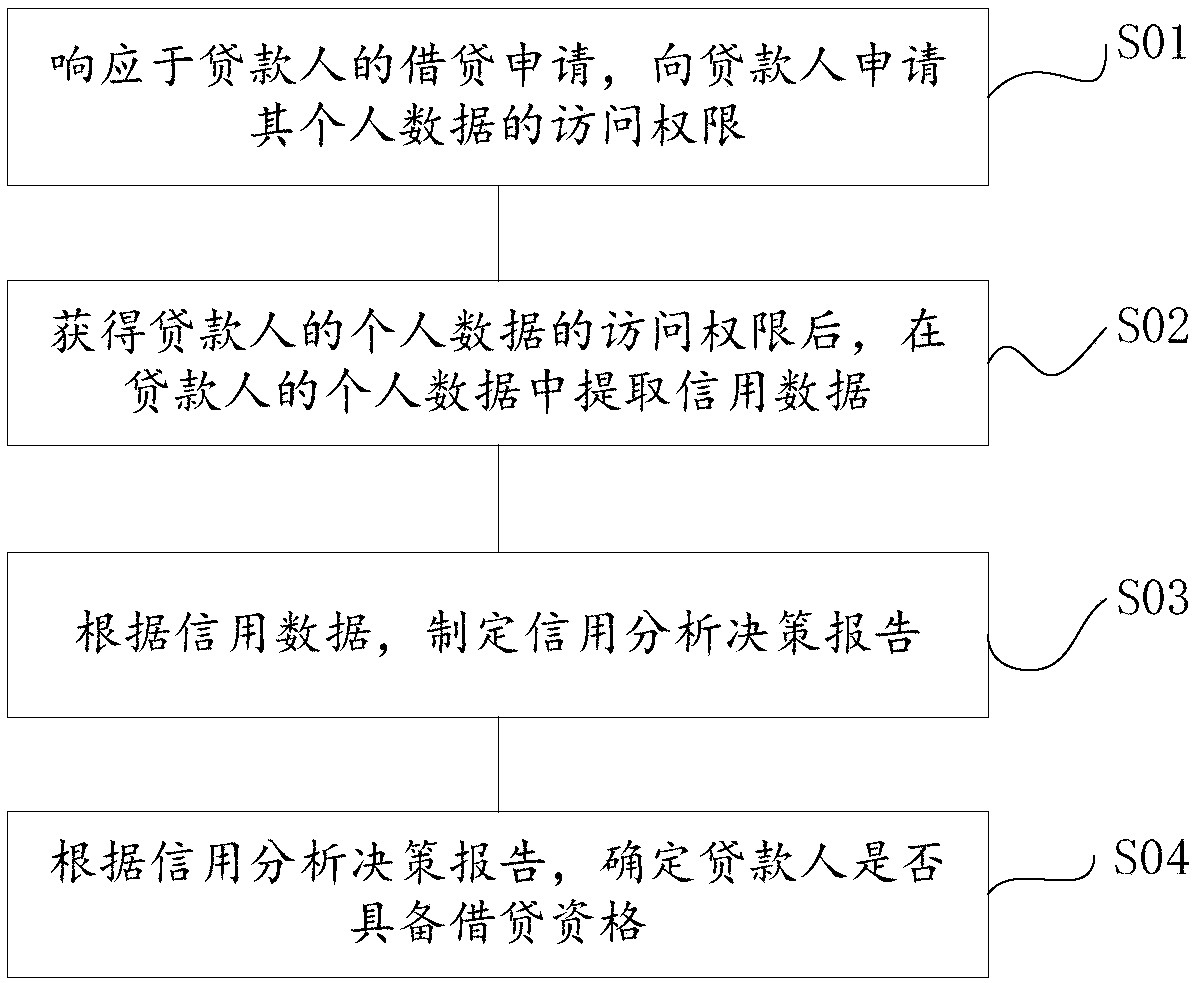

[0044] Such as figure 1 As shown, a loan qualification evaluation method for obtaining credit data online includes the following steps:

[0045] S01: In response to the lender's loan application, apply to the lender for access to their personal data; specifically:

[0046] Based on the personal data pre-entered by the lender;

[0047] Store personal data and generate public-private key pairs;

[0048] Distribute the public key to the lender, and store the lender's personal data confidentially through the private key;

[0049] After receiving the loan application from the lender, send a public key acquisition request to the lender.

[0050] In addition, the personal data here includes information such as the lender's mobile phone number, ID card, education level, marital status, monthly income, city of residence, occupation, household registration, type of loan application, amount, period, purpose, etc. Including: shopping website account number, social security account num...

Embodiment 2

[0084] The present embodiment provides a loan management system, the system includes: a loan institution operation module, a lender operation module, a loan management module, a data collection module, a data analysis module, a data storage module, and a secret key generation module; wherein:

[0085] The lending institution operation module, in response to the lender's loan application, applies to the lender for access to their personal data;

[0086] The data acquisition module and the loan institution operation module extract credit data from the lender's personal data after obtaining the access authority of the lender's personal data;

[0087] Data analysis module, based on credit data, formulate credit analysis decision report;

[0088] Loan management module, according to the credit analysis decision report, to determine whether the lender has the loan qualification;

[0089] The lender enters personal data into the data storage module through the lender operation modul...

Embodiment 3

[0091] This embodiment provides a storage medium, and a computer program is stored in the storage medium. When the computer program is executed by a processor, the steps of the loan qualification evaluation method provided in the first embodiment are implemented.

[0092] Those skilled in the art will understand that embodiments of the present invention may be provided as a method, system or computer program commodity. Accordingly, the present invention can take the form of an entirely hardware embodiment, an entirely software embodiment, or an embodiment combining software and hardware aspects. Furthermore, the invention may take the form of a computer program commodity embodied on one or more computer-usable storage media (including but not limited to disk storage, CD-ROM, optical storage, etc.) having computer-usable program code embodied therein.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com