Patents

Literature

32results about How to "Reduce bad debt rate" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Credit evaluation method and device, storage medium and computer device

ActiveCN110009479AImprove loan securityReduce bad debt rateFinanceProtocol authorisationData scienceComputer device

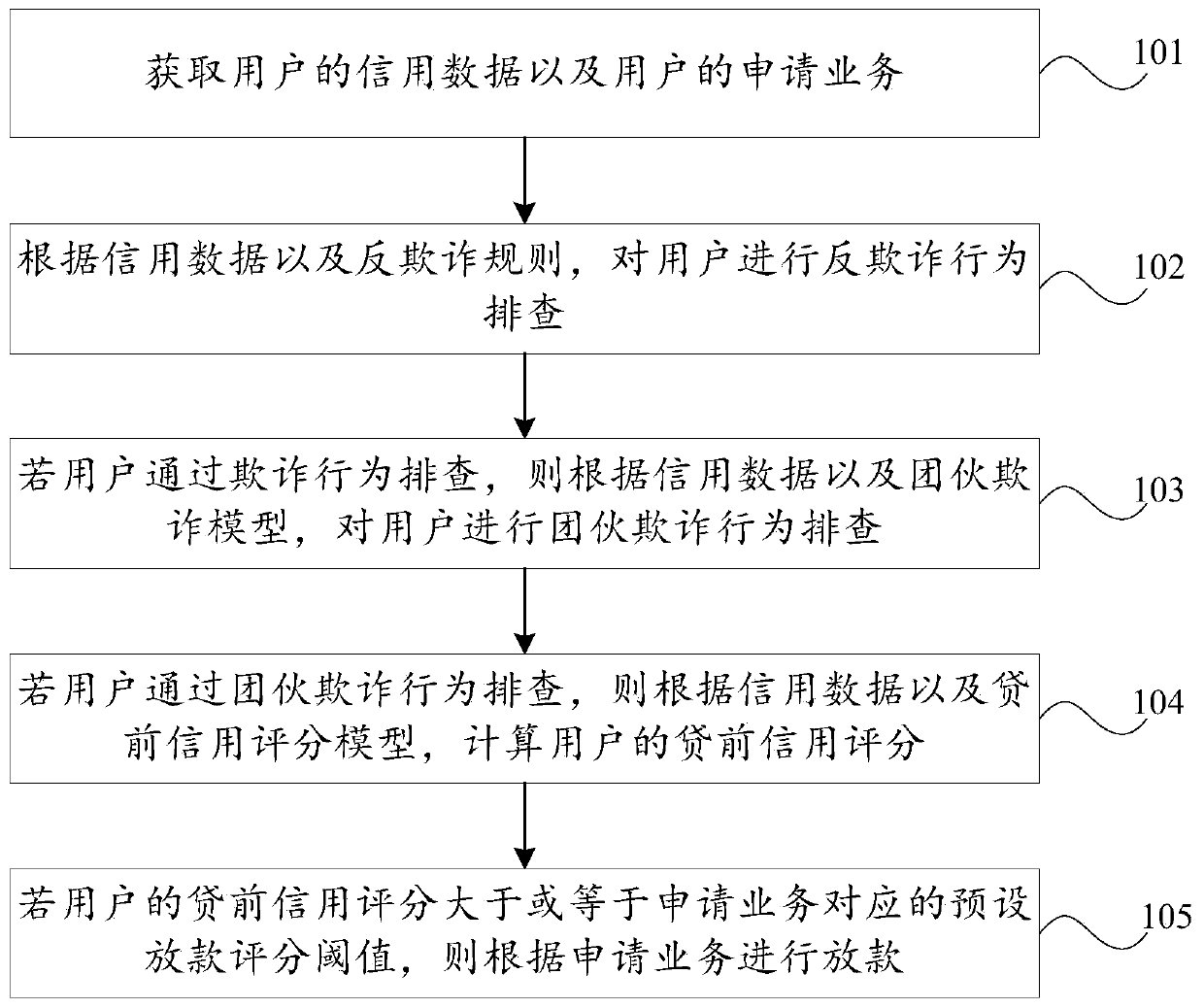

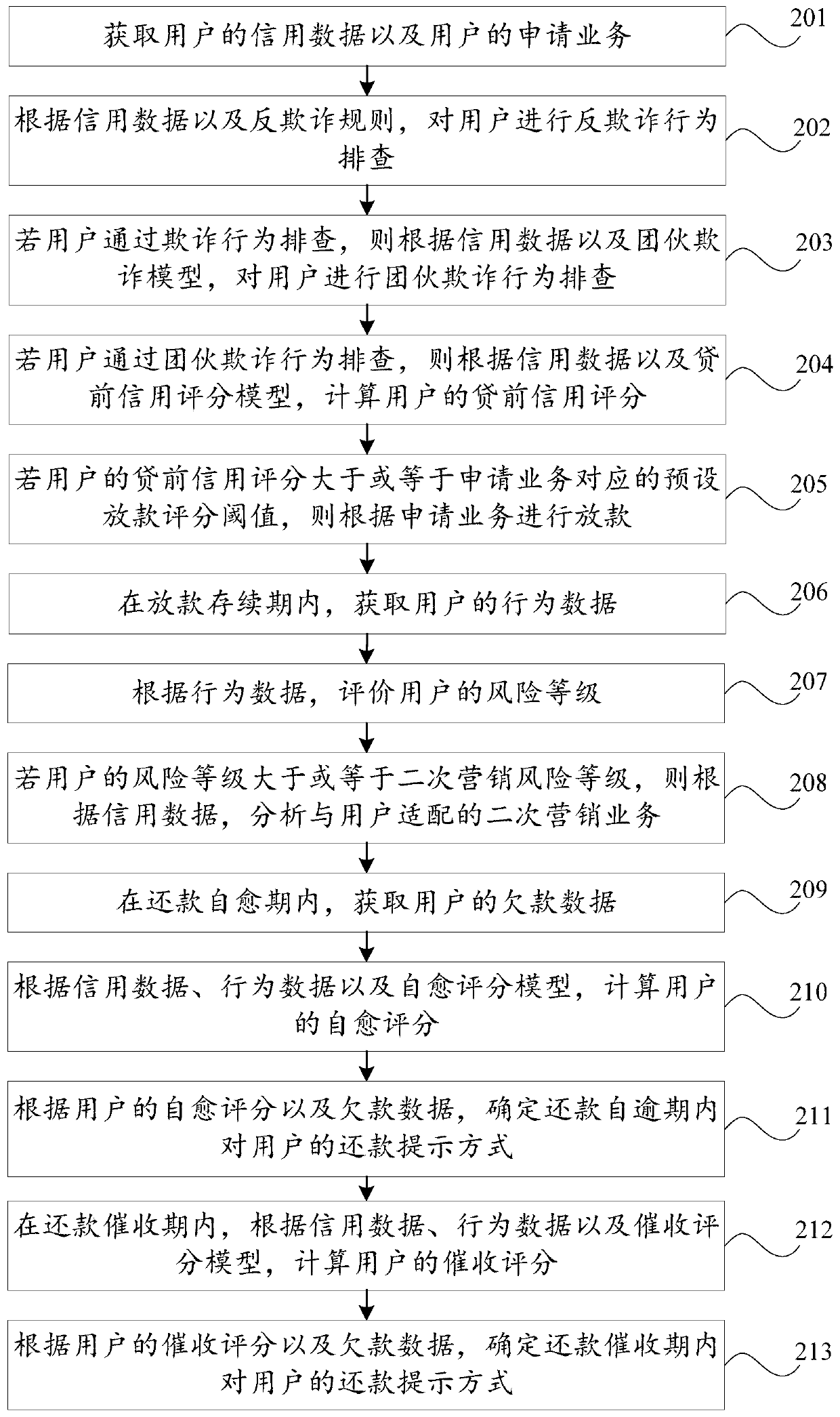

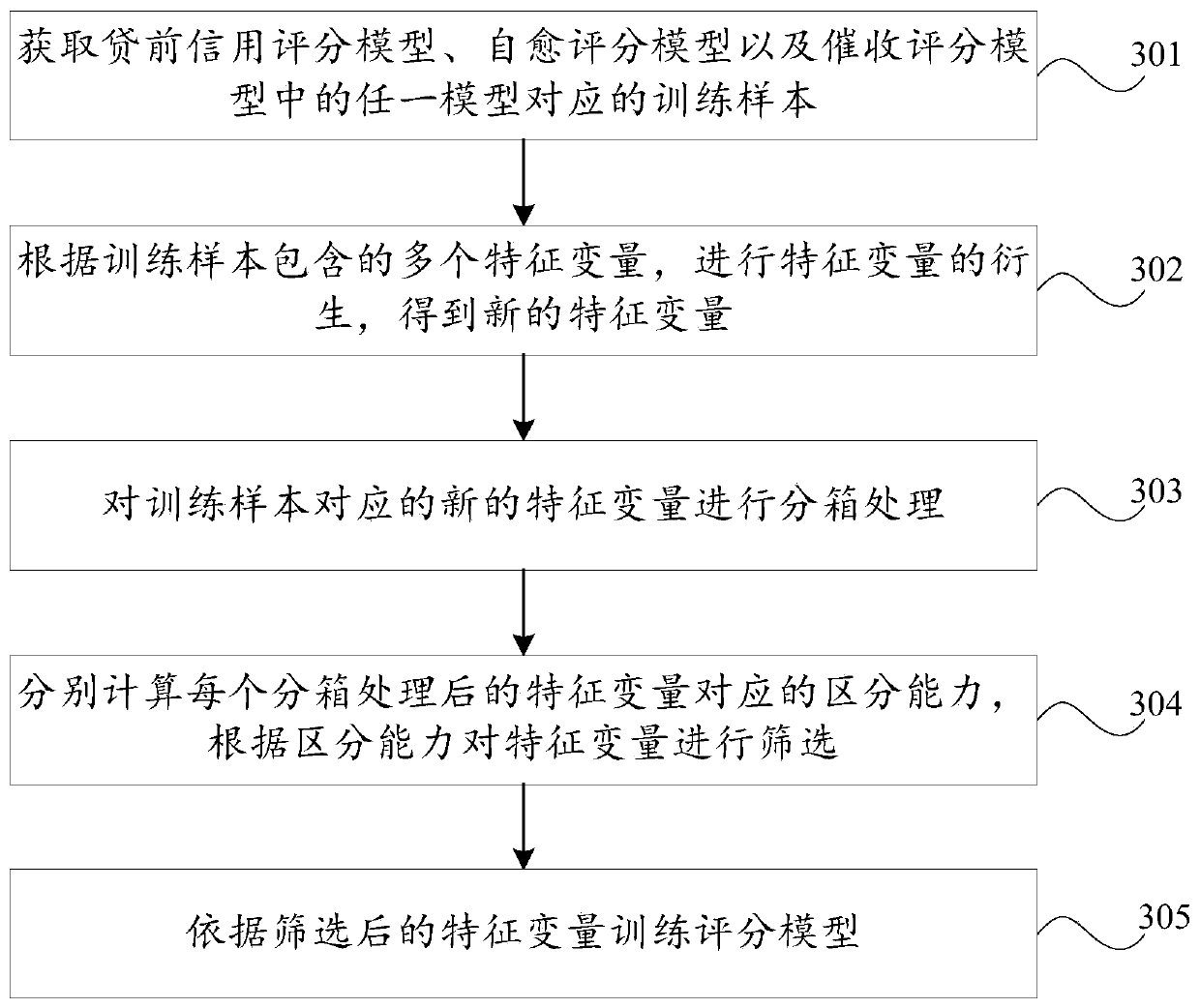

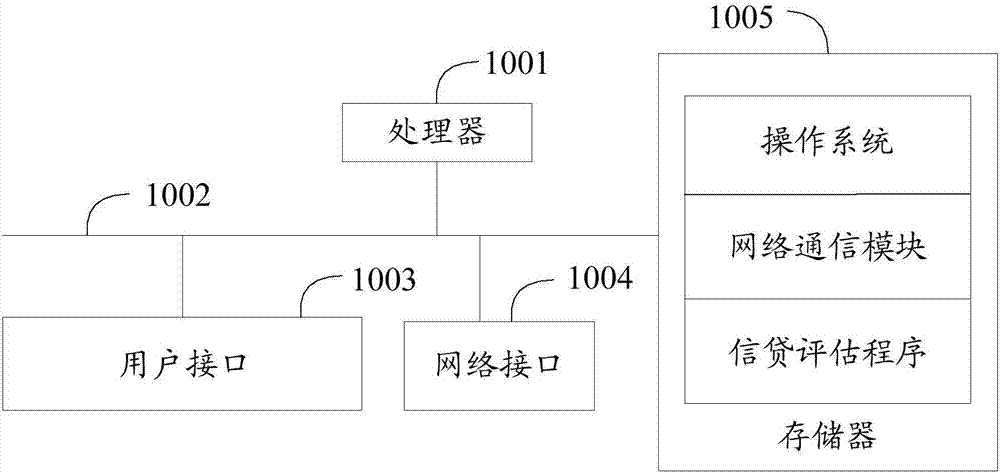

The invention discloses a credit evaluation method and device, a storage medium and a computer device. The method comprises the steps of obtaining credit data of a user and an application service of the user; according to the credit data and the anti-fraud rule, carrying out anti-fraud behavior troubleshooting on the user; if the user passes fraud behavior checking, performing gang fraud behaviorchecking on the user according to the credit data and the gang fraud model; if the user checks the gang fraud behavior, calculating a pre-loan credit score of the user according to the credit data anda pre-loan credit score model; and if the pre-loan credit score of the user is greater than or equal to a preset loaning score threshold corresponding to the application service, loaning according tothe application service. According to the method, large-scale and professional gang fraud behaviors are checked, and then loaning is carried out according to the credit score of the user, so that theloaning safety is improved, and the gang fraud rate can be reduced.

Owner:百融云创科技股份有限公司

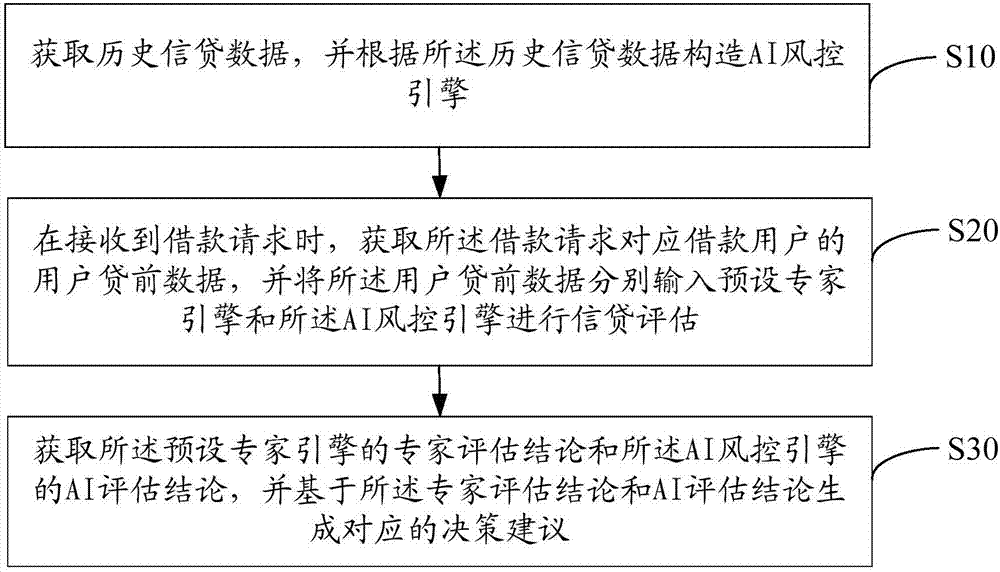

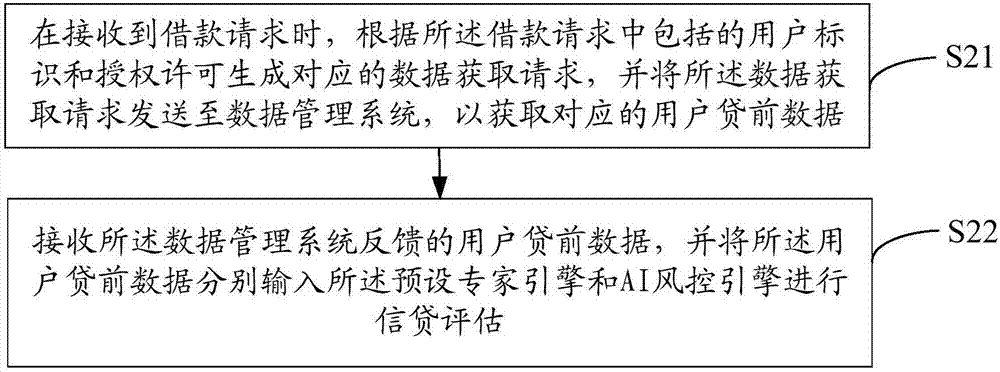

Credit assessment method, device and equipment and computer readable storage medium

InactiveCN107886425AReduce adverse effectsImprove the evaluation effectFinanceRisk ControlDecision taking

The invention discloses a credit assessment method. The method comprises the steps that the historical credit data are acquired and an AI risk control engine is constructed according to the historicalcredit data; when a loan request is received, the user pre-loan data of the borrowing user corresponding to the loan request are acquired and the user pre-loan data are inputted to a preset expert engine and the AI risk control engine to perform credit assessment; and the expert assessment result of the preset expert engine and the AI assessment result of the AI risk control engine are acquired and the corresponding decision and suggestion are generated based on the expert assessment result and the AI assessment result. The invention also discloses a credit assessment device and equipment anda computer readable storage medium. The credit decision and suggestion are acquired by using the double-engine assessment mode so that the adverse influence of the limitation of human thinking on engine construction and the credit assessment process can be greatly reduced, the assessment capability of the risk control model can be enhanced and the rate of bad loans can be effectively reduced.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

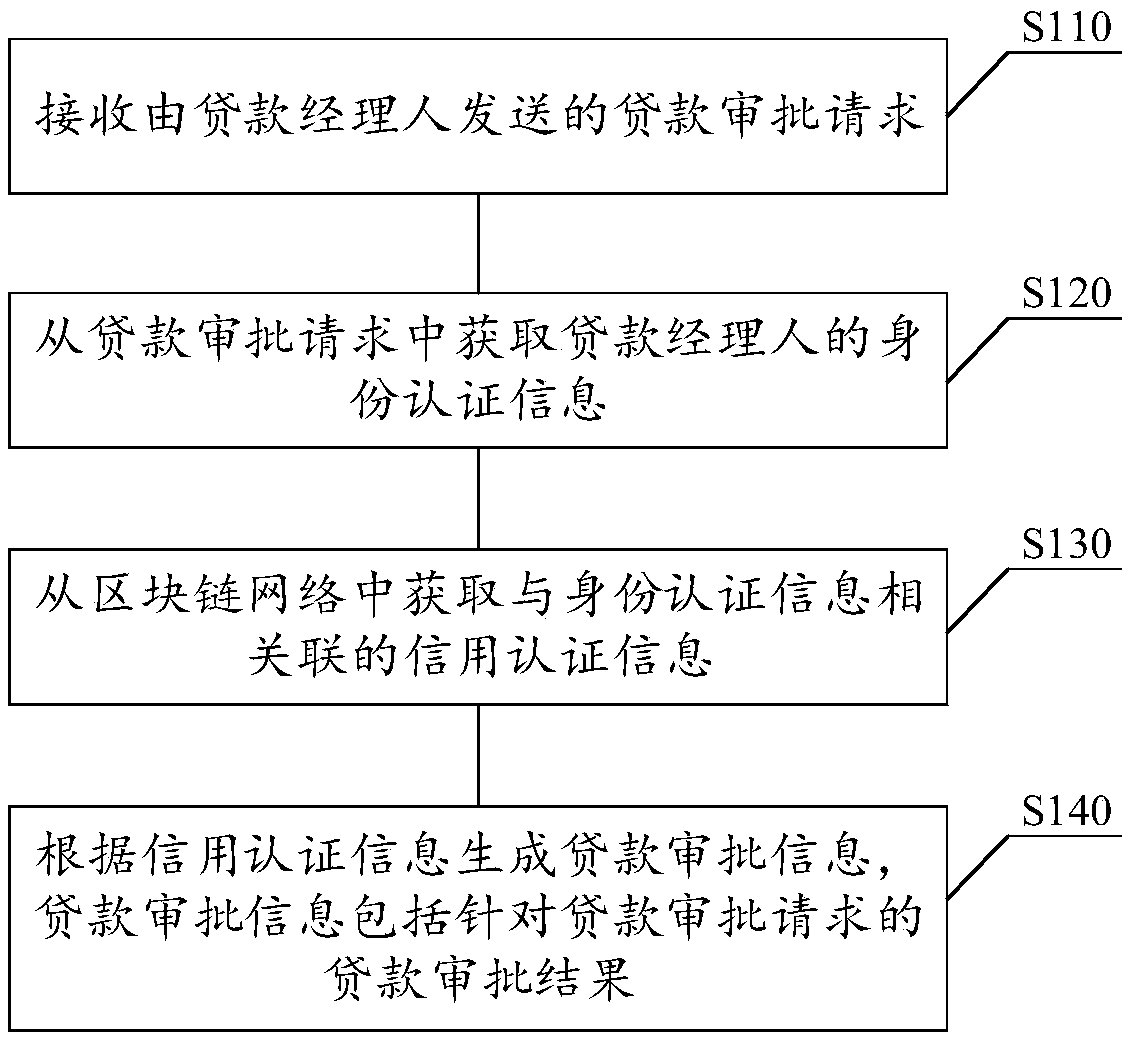

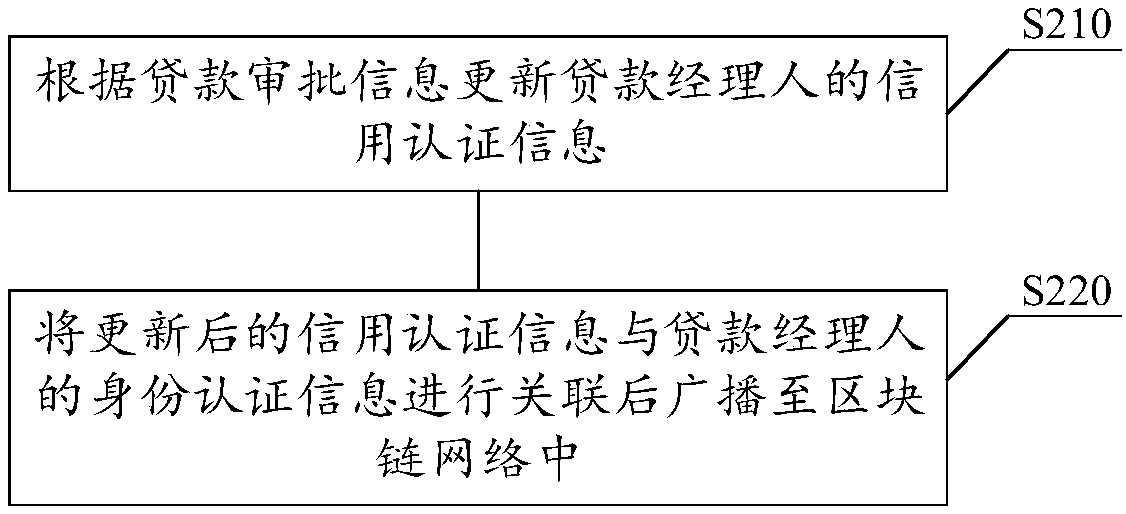

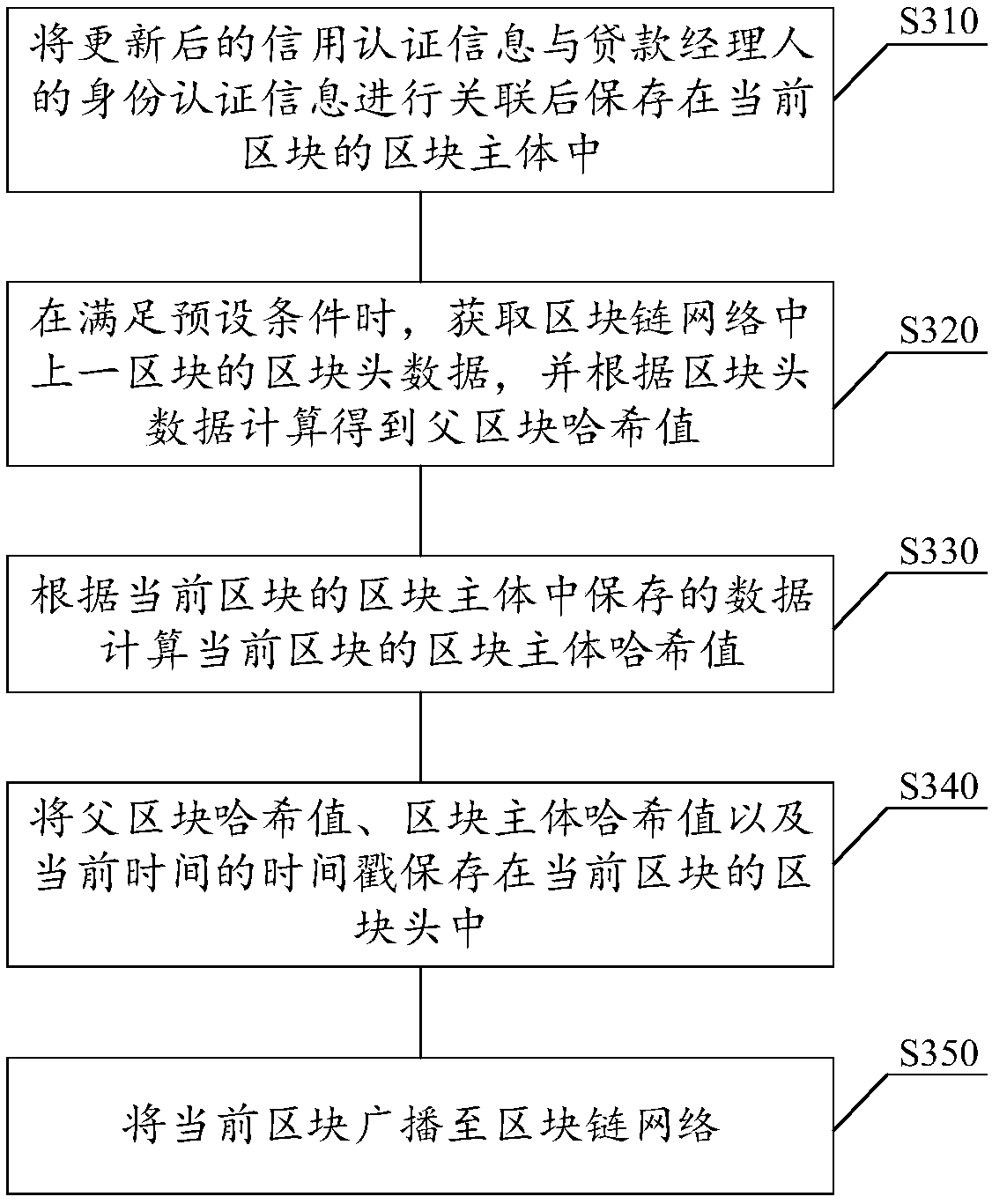

Loan approval method and device based on block chain, storage medium and electronic equipment

InactiveCN109472690AEasy to identifyReduce loan riskFinancePayment protocolsChain networkAuthentication information

The invention relates to a loan approval method and device based on a block chain, a storage medium and electronic equipment. The loan approval method based on the block chain in the embodiment of theinvention is applied to a block chain network storing credit authentication information of a loan manager. The loan approval method comprises the following steps: receiving a loan approval request sent by the loan manager; Obtaining identity authentication information of the loan manager from the loan approval request; Credit authentication information associated with the identity authenticationinformation is acquired from the block chain network; And generating loan approval information according to the credit authentication information, wherein the loan approval information comprises a loan approval result for the loan approval request. The identity authentication information of the loan manager is stored by using the block chain technology, the loan approval evidence can be provided for the financial institution, the loan application with the fraud risk can be conveniently identified, the loan risk is reduced, and the bad account rate is reduced.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

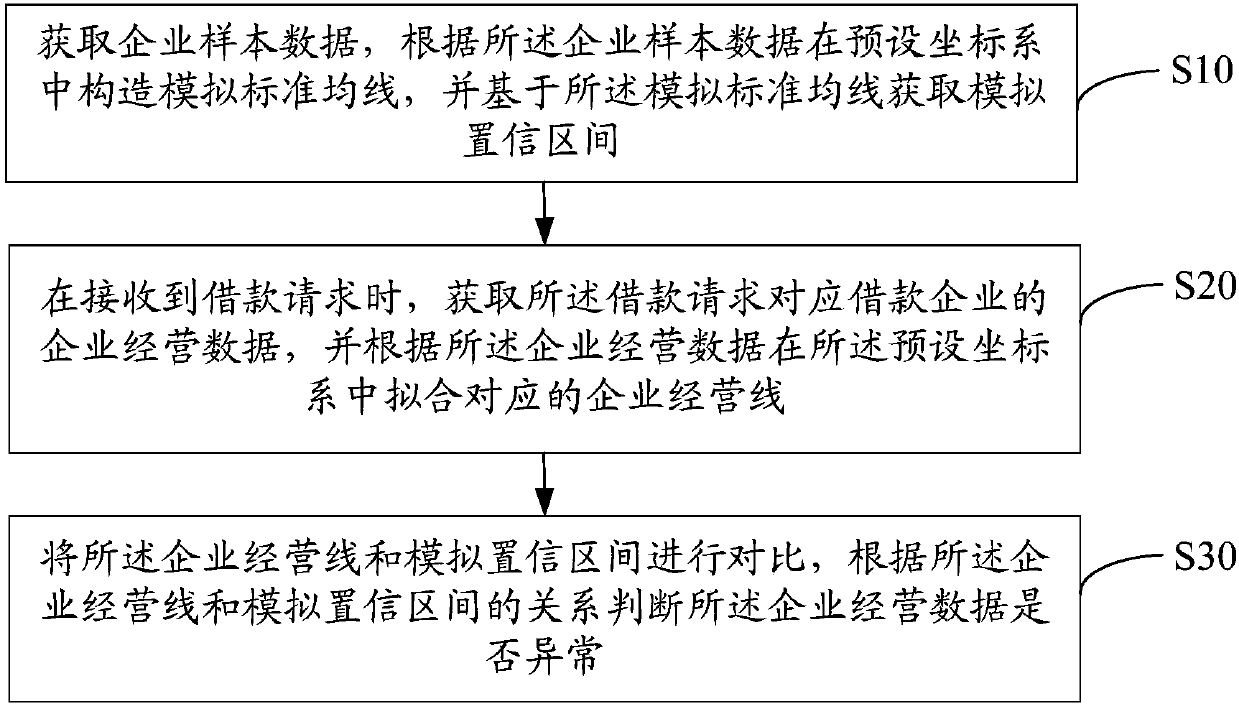

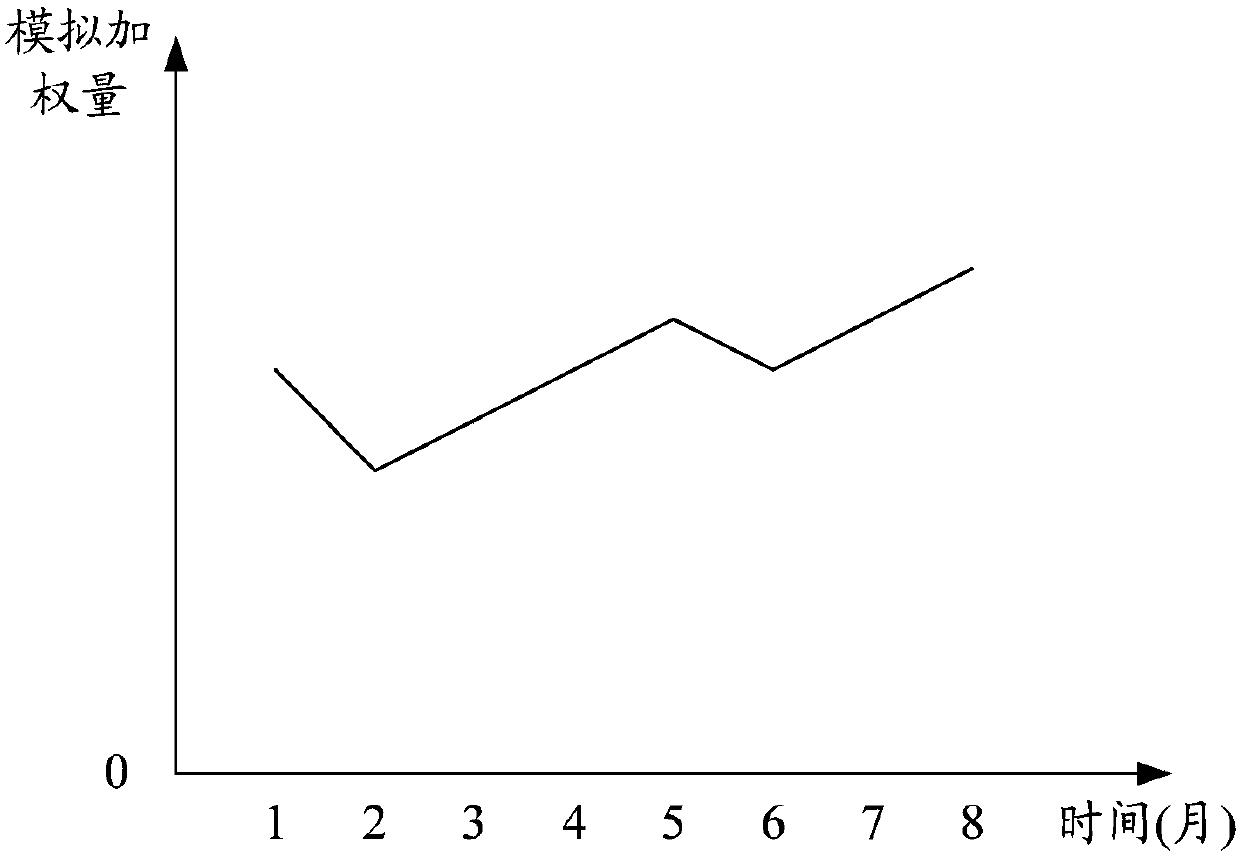

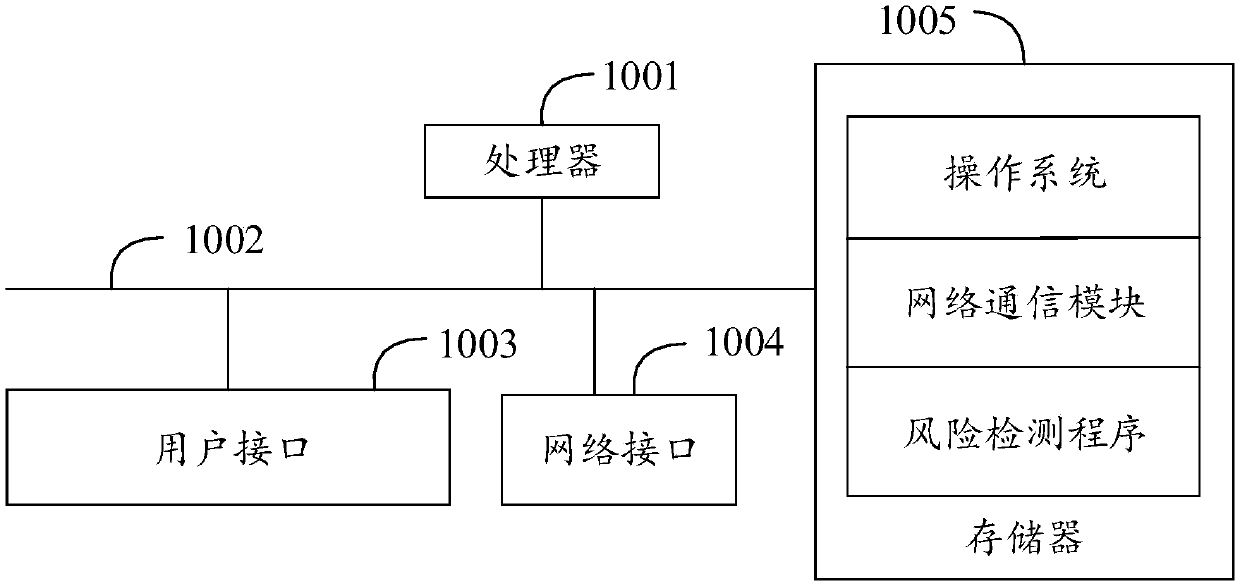

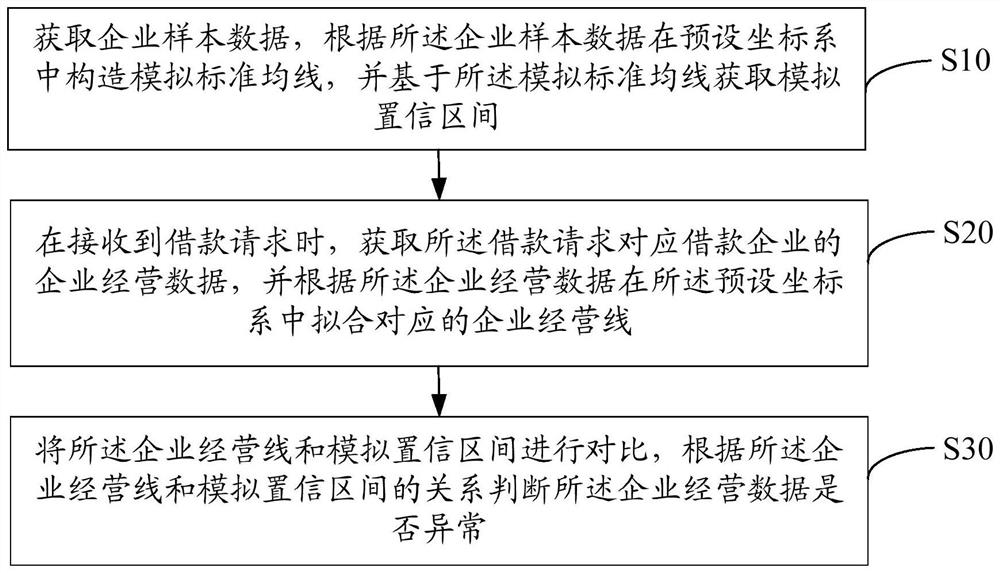

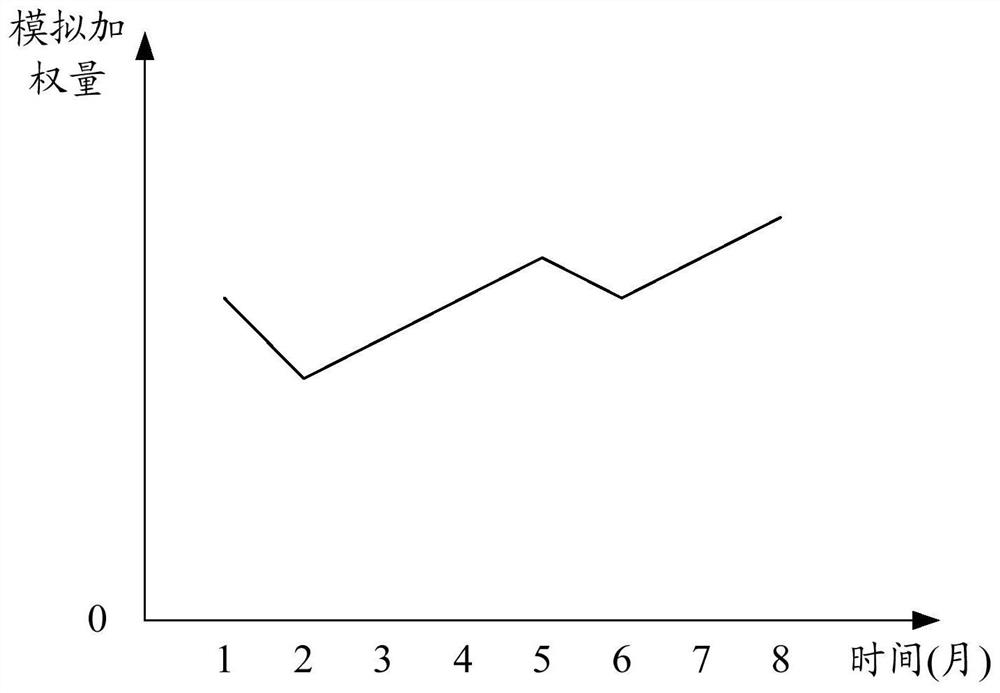

Operation data audit method and device, equipment and computer readable storage medium

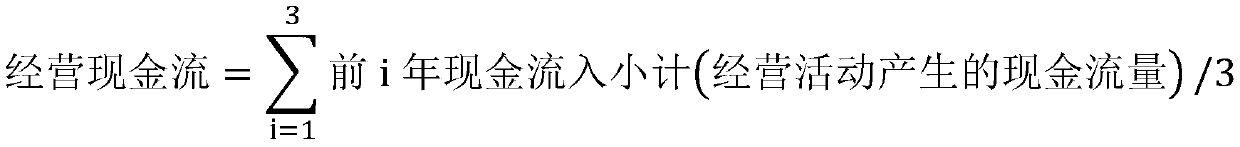

ActiveCN107909472AReduce adverse effectsReduce bad debt rateFinanceConfidence intervalTechnical standard

The invention discloses an operation data audit method. The method comprises steps that enterprise sample data is acquired, an analog standard average line in a preset coordinate system is constructed, and a simulated confidence interval is acquired based on the analog standard average line; when a loan request is received, enterprise business data of a borrowing enterprise corresponding to the load request is acquired, and fitting of a corresponding enterprise business line in the preset coordinate system is carried out; the enterprise business line is compared with the simulated confidence interval to determine whether the enterprise business data is abnormal. The invention further discloses an operation data audit device, equipment and a computer readable storage medium. The method is advantaged in that large-scale enterprise data is learned in a machine learning mode, fitting of the enterprise business average line and the simulated confidence interval is carried out, the operationdata of the borrowing enterprise is audited based on the average line and the simulated confidence interval, whether the operation data of the borrowing enterprises is real is determined, and fraud behaviors of the borrowing enterprise can be identified.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

Information processing method and device

The invention provides an information processing method and device. The method includes: receiving a loan request of a user, wherein the loan request includes loan information; judging, on the basis of the loan information, whether the loan request meets set loan standards; and if yes, lending money to the user, and determining a loan interest rate according to a credit score of the user. According to the method, the loan interest rate can be flexibly determined, high-quality users can be attracted, and thus fund risk and a rate of bad accounts can be reduced to a certain extent.

Owner:SIMPLECREDIT MICRO LENDING CO LTD

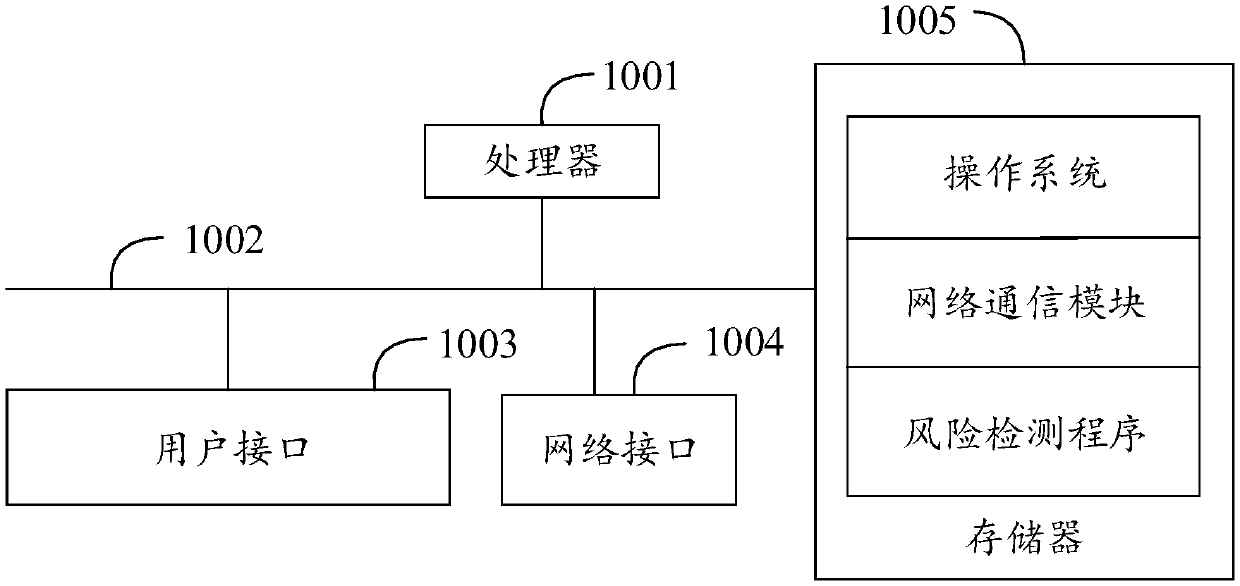

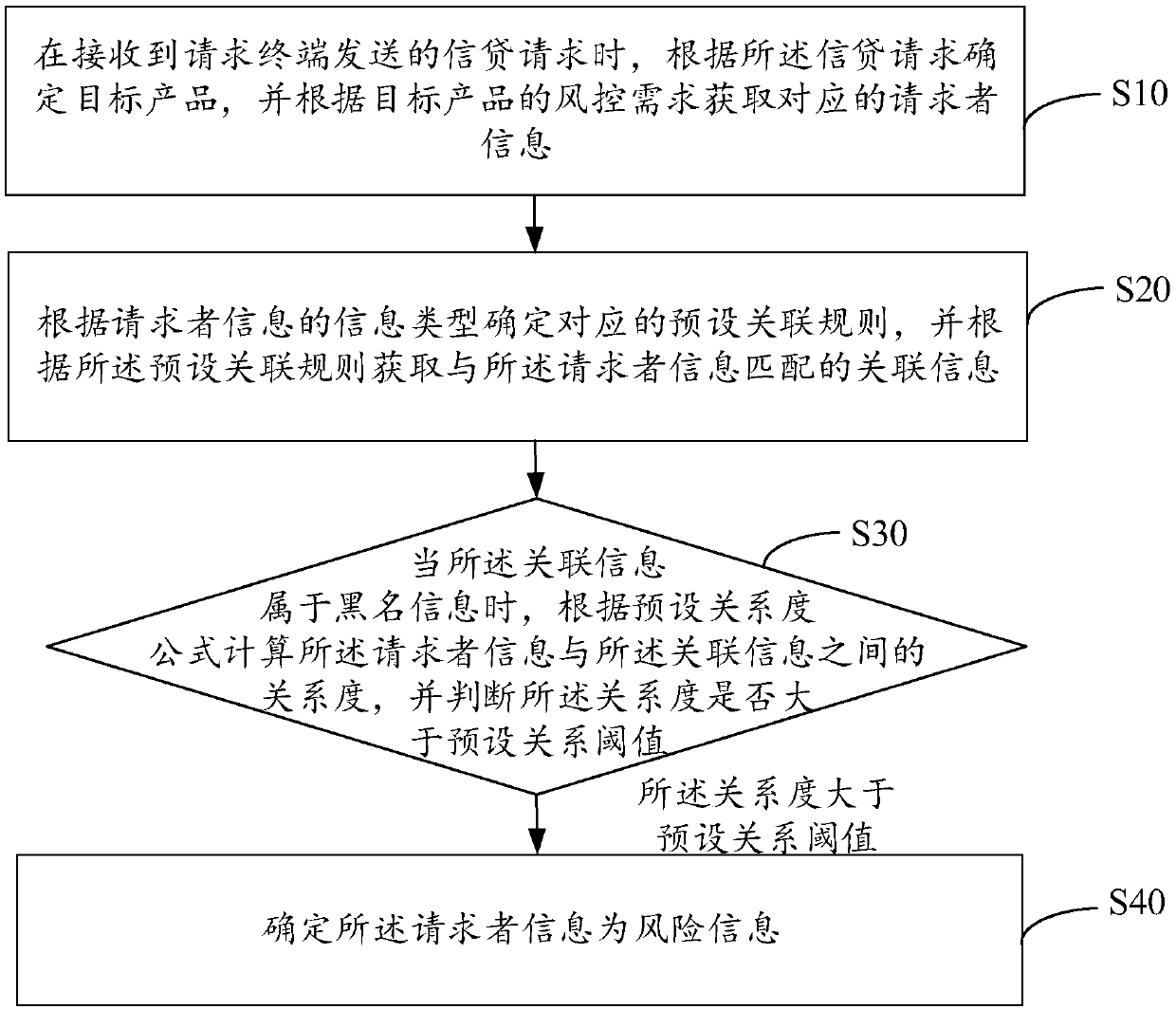

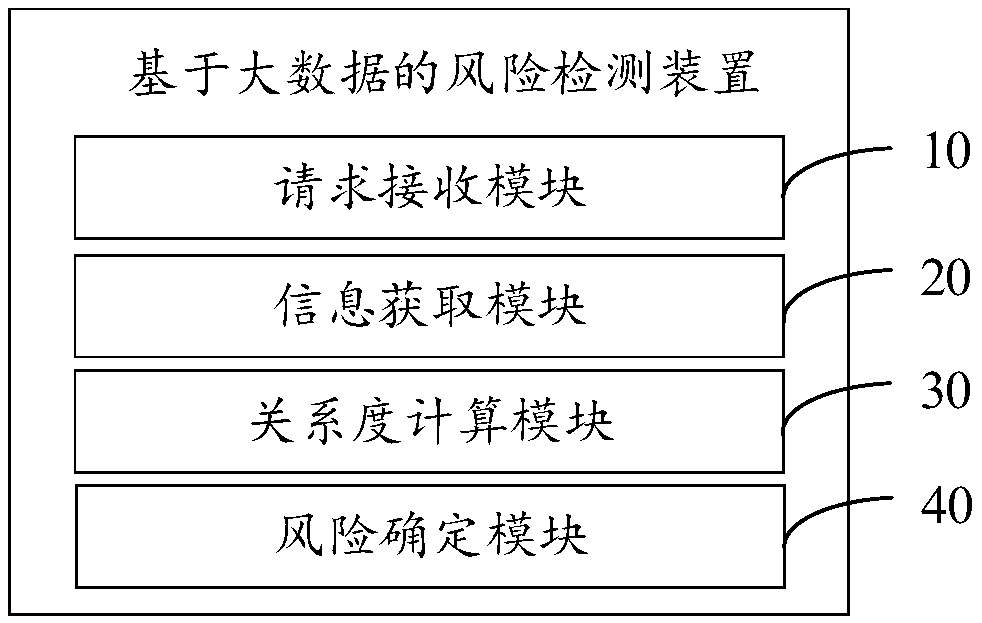

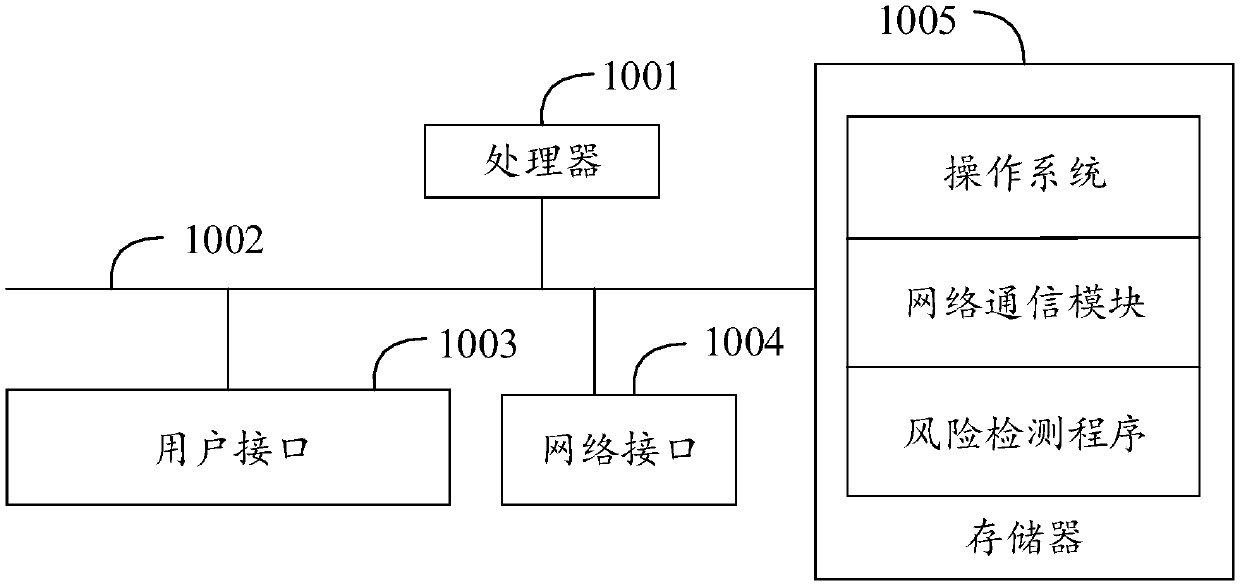

Risk detection method and device based on big data, apparatus and storage medium

The invention provides a risk detection method and device based on big data, an apparatus, and a readable storage medium. In the course of credit risk analysis, according to the need of risk control,we can get the requester information of the loan requester, and then establish the relationship between the requester information and other information in the way of relationship, so that the isolatedrequester information can be integrated with other information to form the information association map (information association network); Combined with the black (or gray) processing logic to detectthe credit risk, so as to detect the loan terminal of loan applicant by the way of big data analysis, improve the accuracy of credit risk detection, can more effectively carry out early warning of potential risks, can find and avoid risks and reduce the bad debt rate of loan as soon as possible.

Owner:PING AN TECH (SHENZHEN) CO LTD

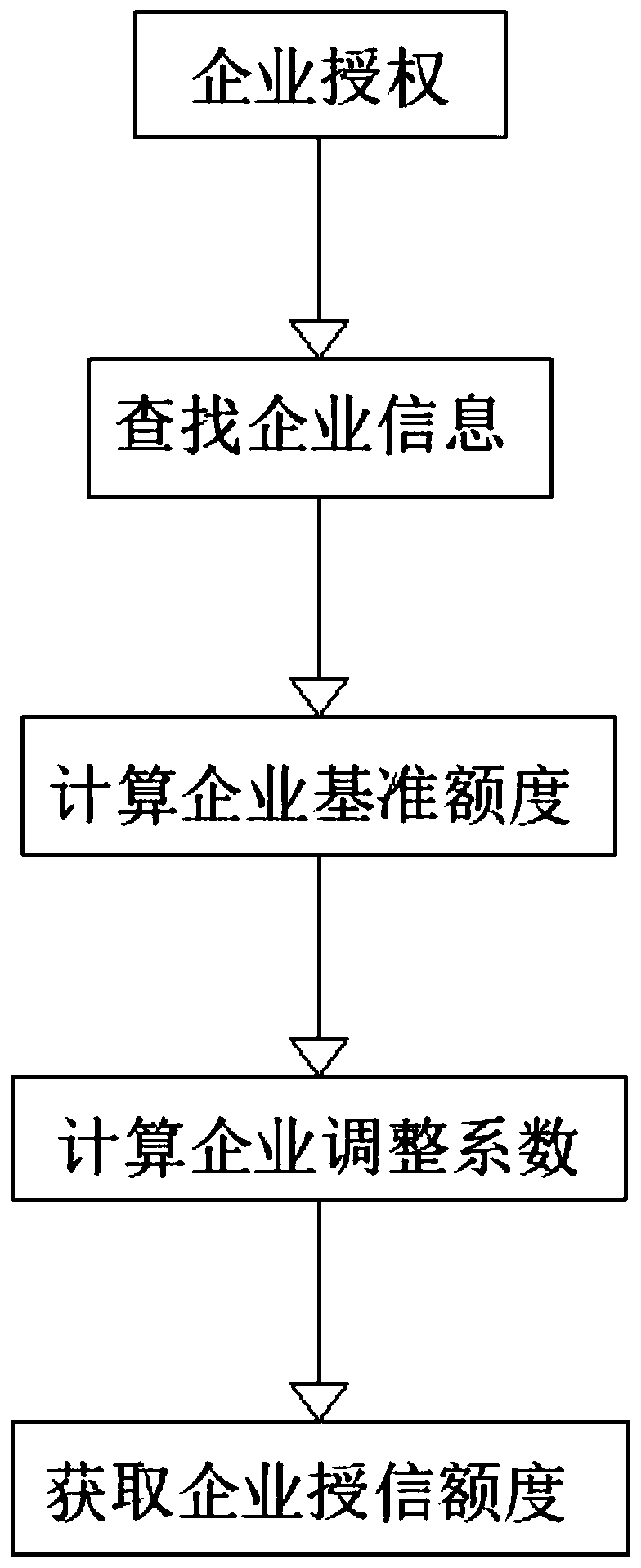

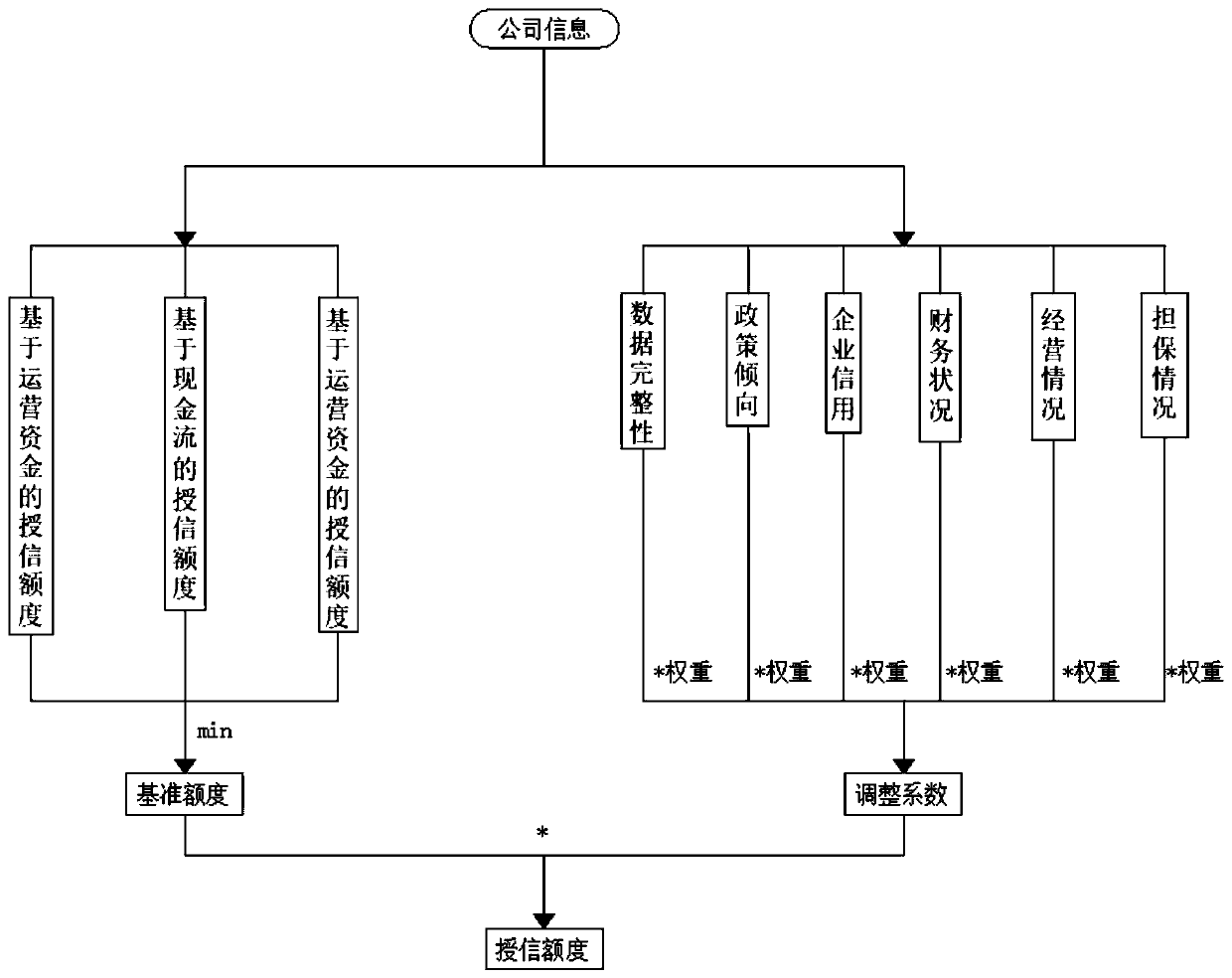

Analysis system and method for comprehensively evaluating credit line of enterprise

InactiveCN111062801AReduce riskReduce the risk of fraudFinanceBusiness enterpriseEnterprise computing

The invention discloses an analysis system and method for comprehensively evaluating credit line of enterprises, relates to the technical field of finance, and specifically relates to the analysis system and method for comprehensively evaluating credit line of enterprises, and the system comprises: a reference line model module which outputs a reference line matched with the condition of an enterprise according to the information of the enterprise; and an adjustment coefficient module that is used for adjusting the credit line of the enterprise on the basis of the reference line. The inventiondiscloses the analysis system and method for comprehensively evaluating the credit line of an enterprise. Multi-aspect information of assets and operation of enterprises is integrated, thus obtaininga coefficient index conforming to the enterprise by utilizing the plurality of dimension data, and calculating a reference quota adjustment coefficient matched with the enterprise for the enterprise;according to the credit line analysis system and method, the information participating in credit line evaluation of the enterprise is relatively comprehensive, so that the more accurate credit line is obtained, the risk of the enterprise is effectively reduced, the fraud risk of the enterprise is effectively reduced, and the bad debt rate of the credit enterprise using the system and method is reduced.

Owner:泰州企业征信服务有限公司

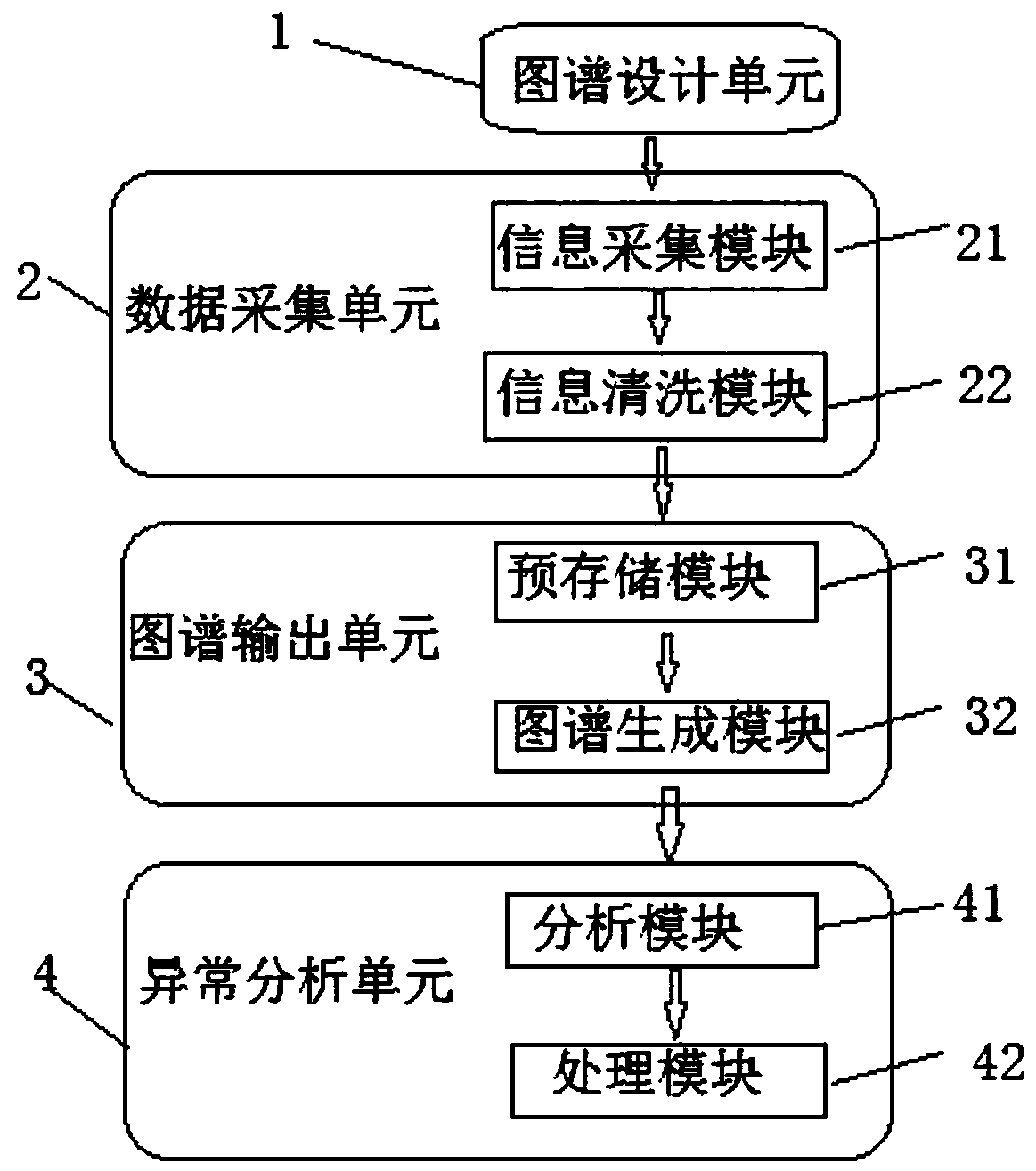

Financial knowledge graph visual query and multi-dimensional analysis system

PendingCN110837538AAvoid asset lossReduce bad debt rateFinanceVisual data miningEngineeringKnowledge graph

The invention provides a financial knowledge graph visual query and multi-dimensional analysis system. The financial knowledge graph visual query and multi-dimensional analysis system comprises a graph design unit used for designing the structure of a graph database according to the query requirement of financial data; a data acquisition unit used for acquiring a plurality of unstructured sample source data, cleaning the sample source data, and storing the cleaned sample source data into the atlas database as sample data; an atlas output unit used for importing the sample data into the atlas database to output a knowledge atlas; and an exception analysis unit used for extracting exception data from the knowledge graph and carrying out multi-dimensional analysis according to exception attributes. The method has the beneficial effects that the method is used for auditing the loan application client in financial loan business, and fraud behaviors can be avoided to a great extent, so thatthe bad debt rate of a financial platform can be reduced, and asset loss of the financial platform is avoided.

Owner:北京中科捷信信息技术有限公司

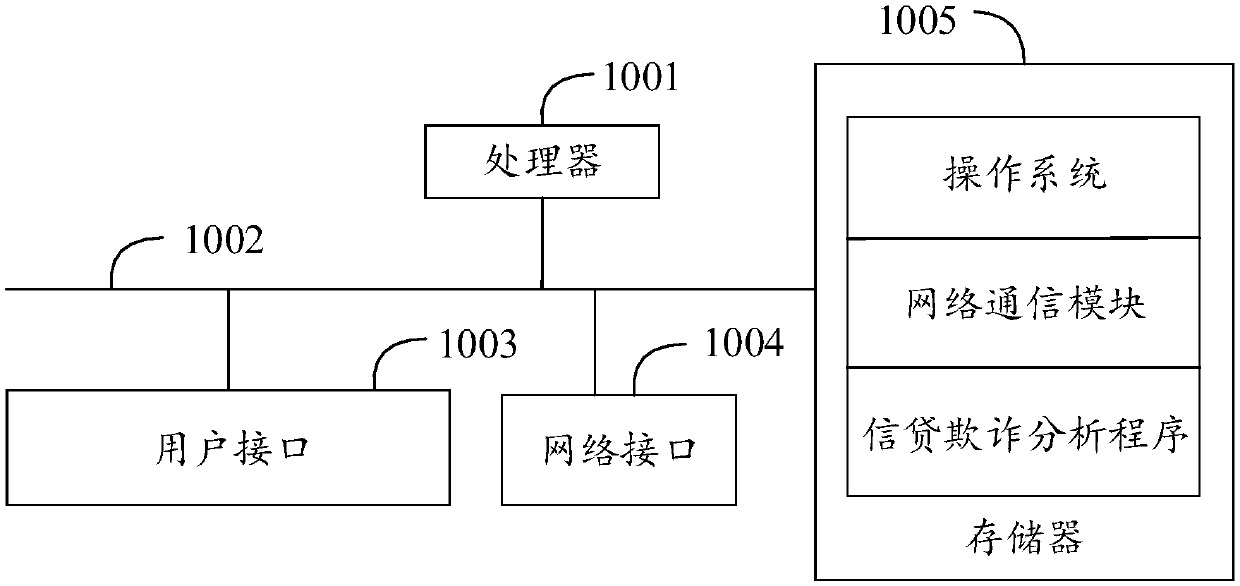

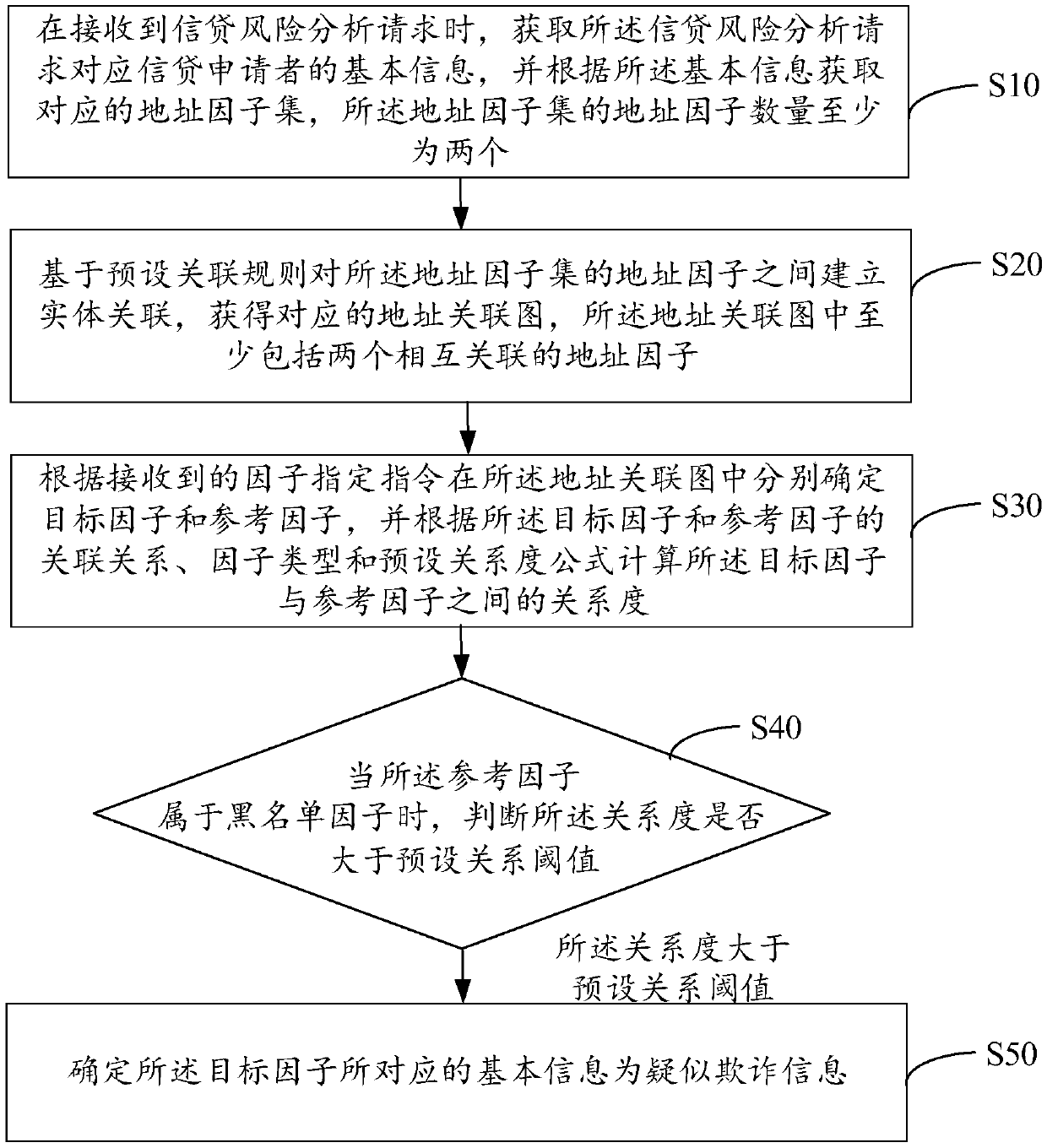

Credit fraud analysis method, device and equipment and computer readable storage medium

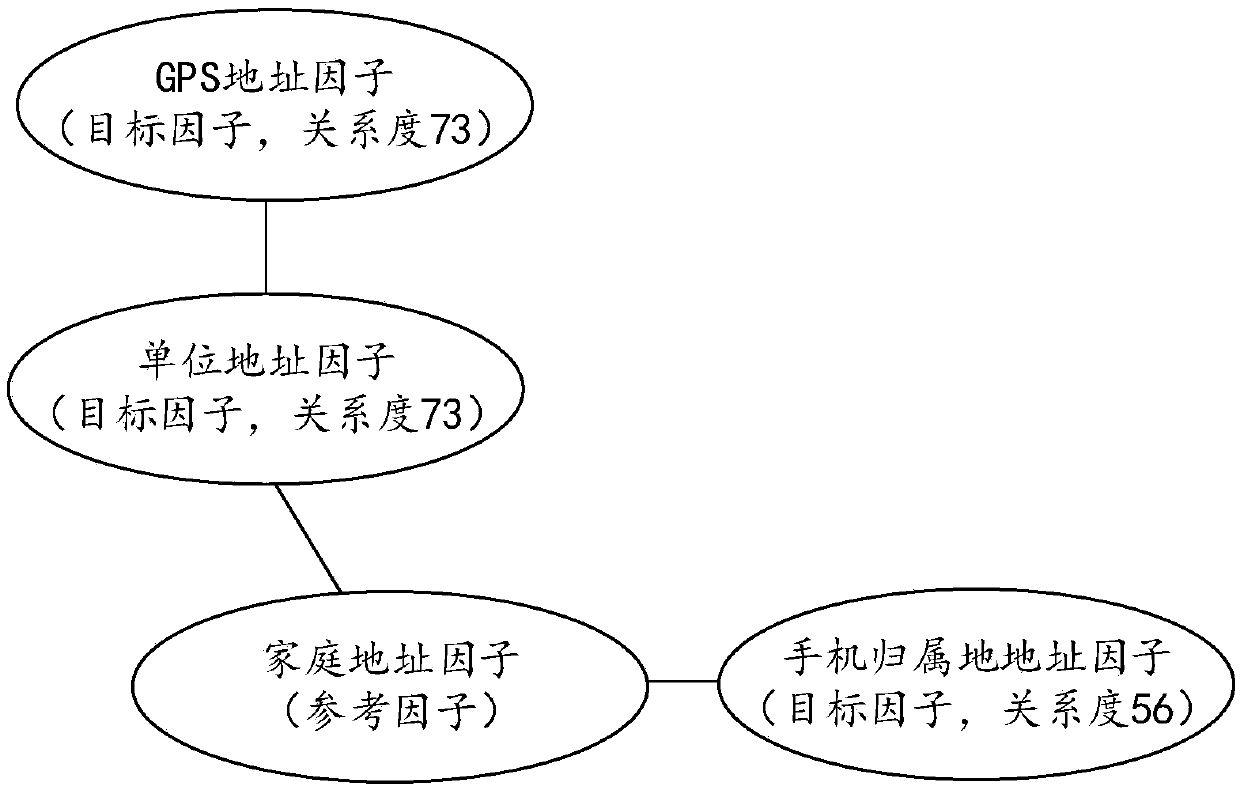

The invention provides a credit fraud analysis method. The invention discloses a device, equipment and a computer readable storage medium. integrating and associating multiple kinds of address information of the loan applicant in a relationmanner; the contact between the address information can be determined; the potential credit fraud risk is predicted by combining the processing logic of black (or grey) dyeing; Therefore, correlation risk detection is carried out on the loan terminal of the loan applicant in a big data analysis mode, the accuracy of credit analysis is improved, early warningcan be carried out on potential risks more effectively, the risks can be found and avoided as soon as possible, and the bad account rate is reduced.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

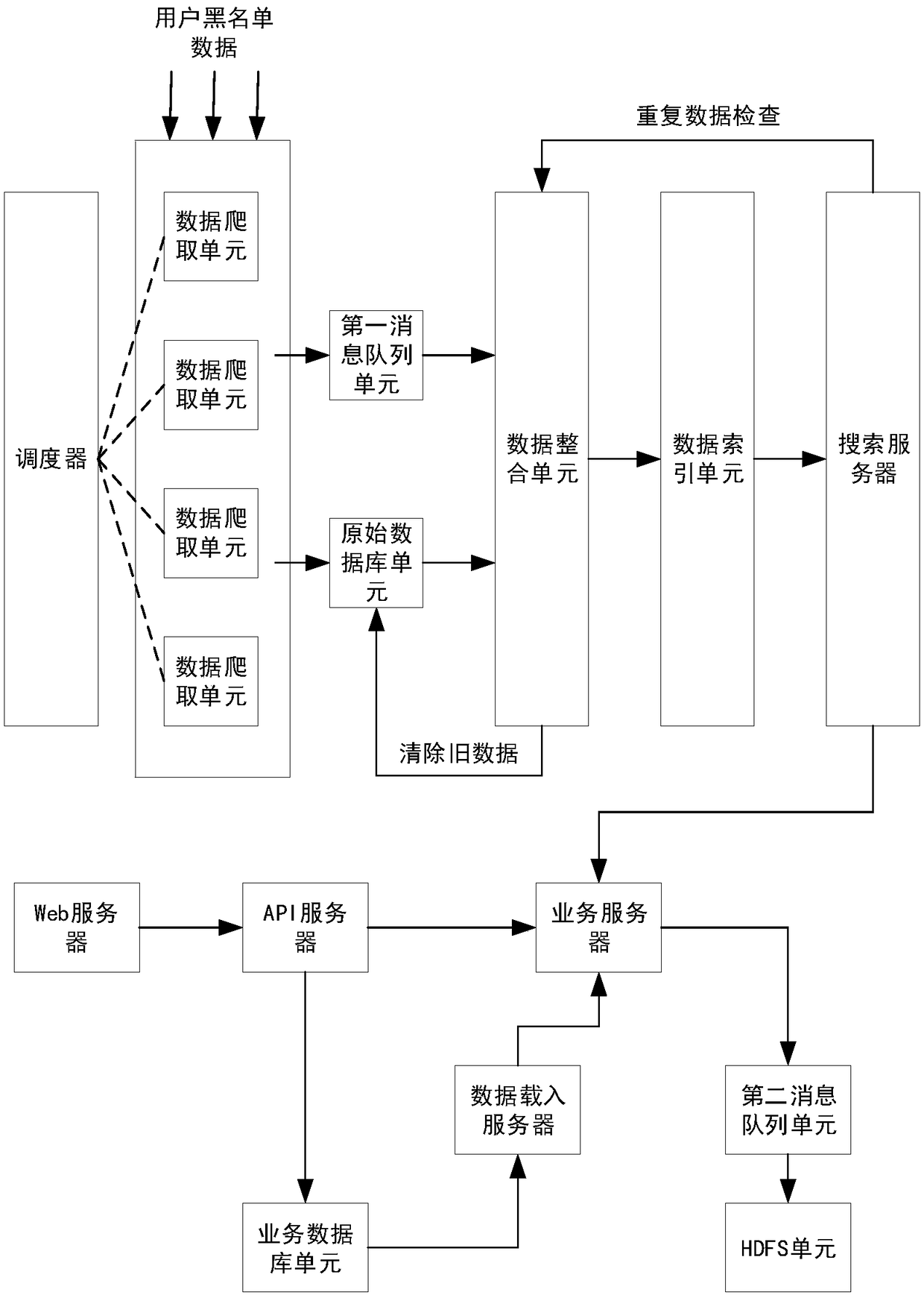

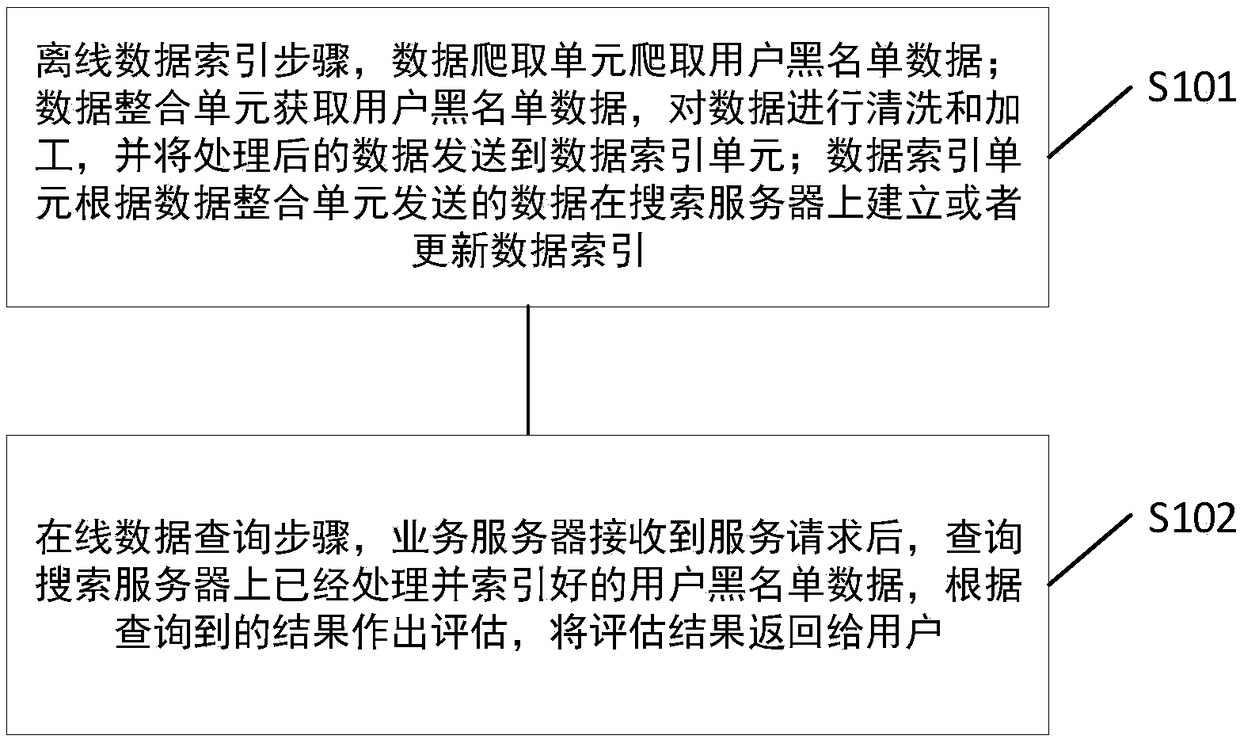

Internet financial blacklist system based on big data and application method thereof

InactiveCN109165335AReduce bad debt rateImprove overall efficiency and accuracyFinanceWeb data queryingData queryAnalysis data

The invention discloses an Internet financial blacklist system based on big data and an application method thereof. A massive amount of Internet financial blacklist data is processed offline by an offline data indexing module, and features are extracted and indexed efficiently. When the service request is received, the related blacklist data of the user to be granted credit is queried in real timeby the online data query module. The online data query module directly utilizes the results generated by the offline service to evaluate and calculate the service data in real time and give a quick response. Data crawling and indexing can be resource intensive, and it takes a long time to clean the data. The invention can directly inquire the processed and indexed data for the service request, quickly make the evaluation, and return the result to the customer, thus greatly reducing the bad debt rate, and improving the overall efficiency and accuracy of the financial risk control.

Owner:杭州排列科技有限公司

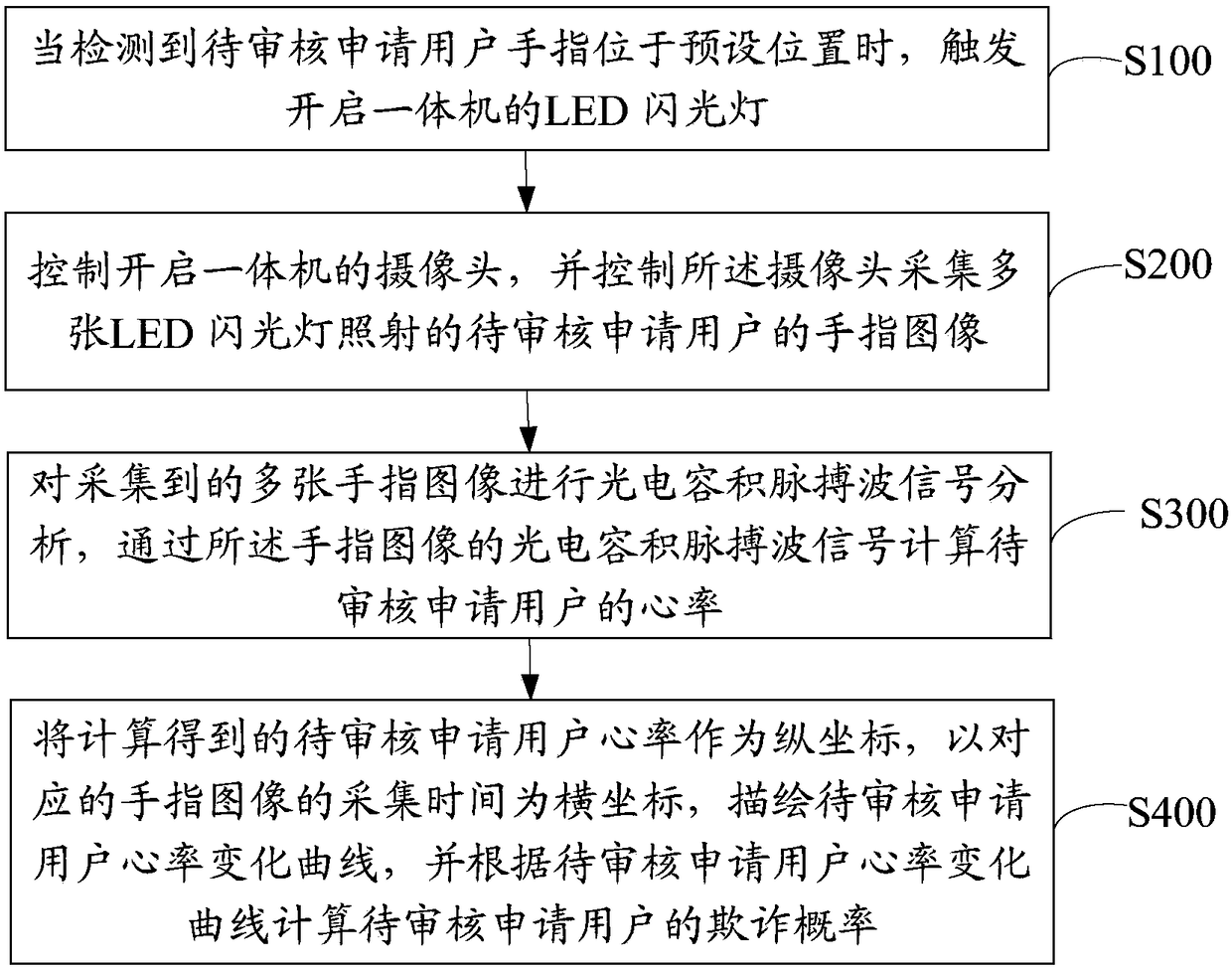

Method, device and equipment for auditing fraud by using all-in-one machine and readable storage medium

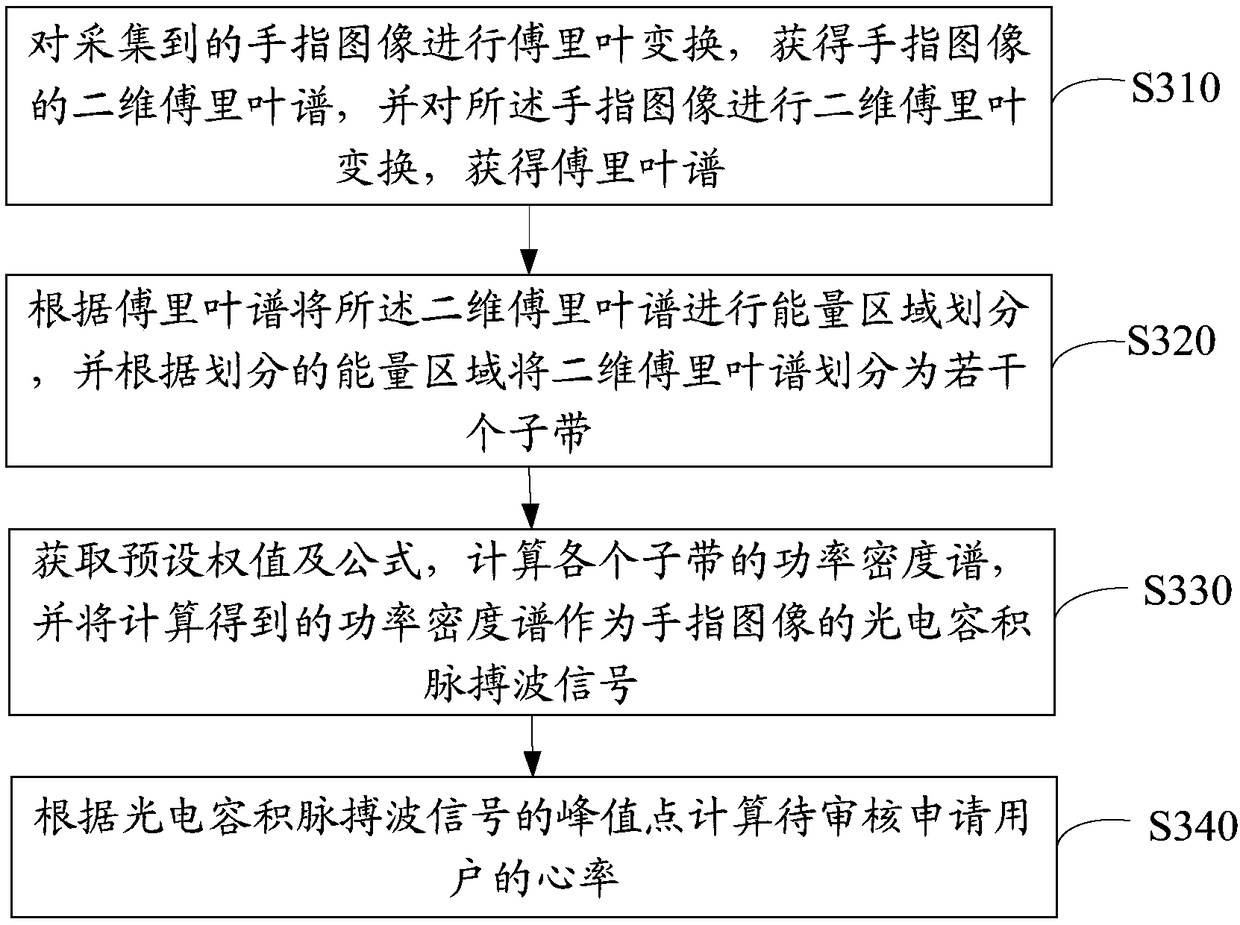

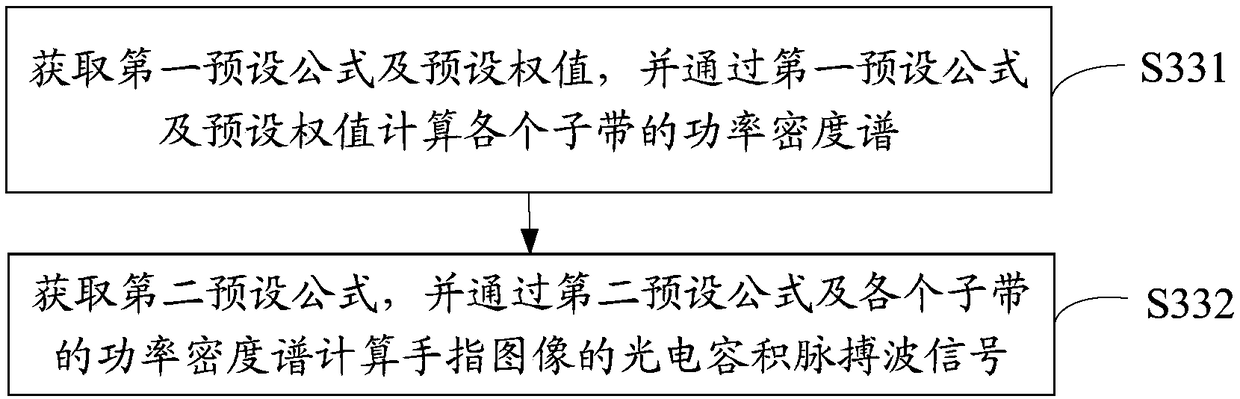

PendingCN108537186AIncrease success rateReduce bad debt rateFinanceSensorsAcquisition timeHeart rate change

The invention discloses a method, a device and equipment for auditing fraud by using an all-in-one machine and a readable storage medium. The method comprises the following steps: When fingers of an application user to be audited are detected to be in a preset position, triggering to turn on an LED flash lamp of the all-in-one machine; controlling to turn on a camera of the all-in-one machine, andcontrolling the camera to acquire a plurality of finger images of the application user to be audited under the irradiation of the LED flash lamp; performing photoelectric volume pulse wave signal analysis on the acquired finger images, and calculating the heart rate of the application user to be audited through photoelectric volume pulse wave signals of the finger images; with the calculated heart rate of the application user to be audited as an ordinate and the acquisition time of the corresponding finger images as an abscissa, depicting a heart rate change curve of the application user to be audited, and calculating the fraud probability of the application user to be audited according to the heart rate change curve of the application user to be audited. Whether a user has the fraud canbe known through the heart rate, so that the success rate of identifying the fraud is increased.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

Pledge subject matter intelligent management monitoring system and method based on Internet of Things block chain

PendingCN111222830AKnow the situation in real timeImprove the level ofFinanceDatabase distribution/replicationData connectionVideo monitoring

The invention relates to the technical field of Internet of Things warehouse intelligent management. The invention discloses a pledge subject matter intelligent management monitoring system and methodbased on an Internet of Things block chain. The system comprises a warehouse which is provided with a video monitoring device and is used for storing pledge subject matters, a data monitoring modulearranged at a key asset point of a pledge party, at least three supervision computers / hand-held devices respectively used by the pledge party, a pledgee party and a third supervision party, and a server in data connection with the video monitoring device, the data monitoring module and the supervision computers / hand-held devices and connected to the Internet. The management monitoring method comprises a pledge input step, a pledge supervision step, a pledge supervision step and a supervision monitoring step. The supervising computer / handheld devices for visually accessing monitoring data are provided for the pledge party, the pledgee party and the third supervising party participating in pledge items, and a secret key and key information are uploaded to a block chain to be stored, so thatthe non-modifiability of the data and the traceability of a data source and an access record are ensured.

Owner:CHENGDU JIAYITONG INFORMATION TECH CO LTD

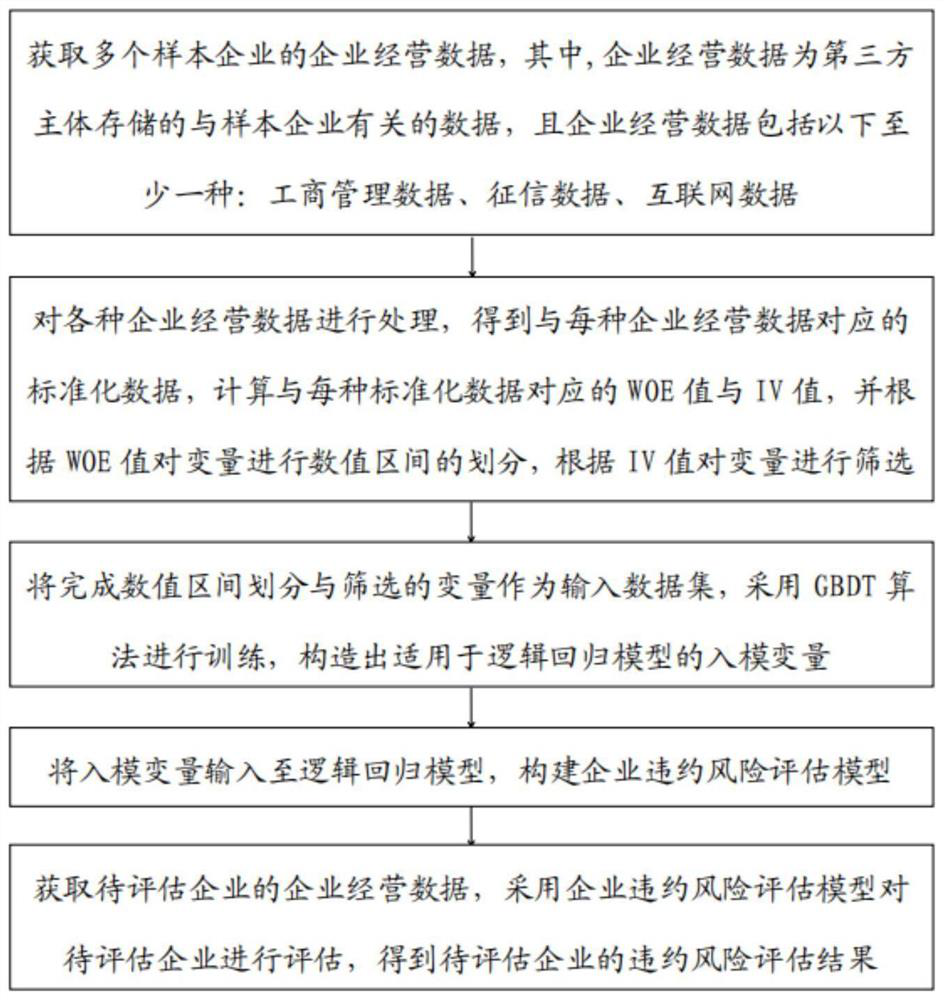

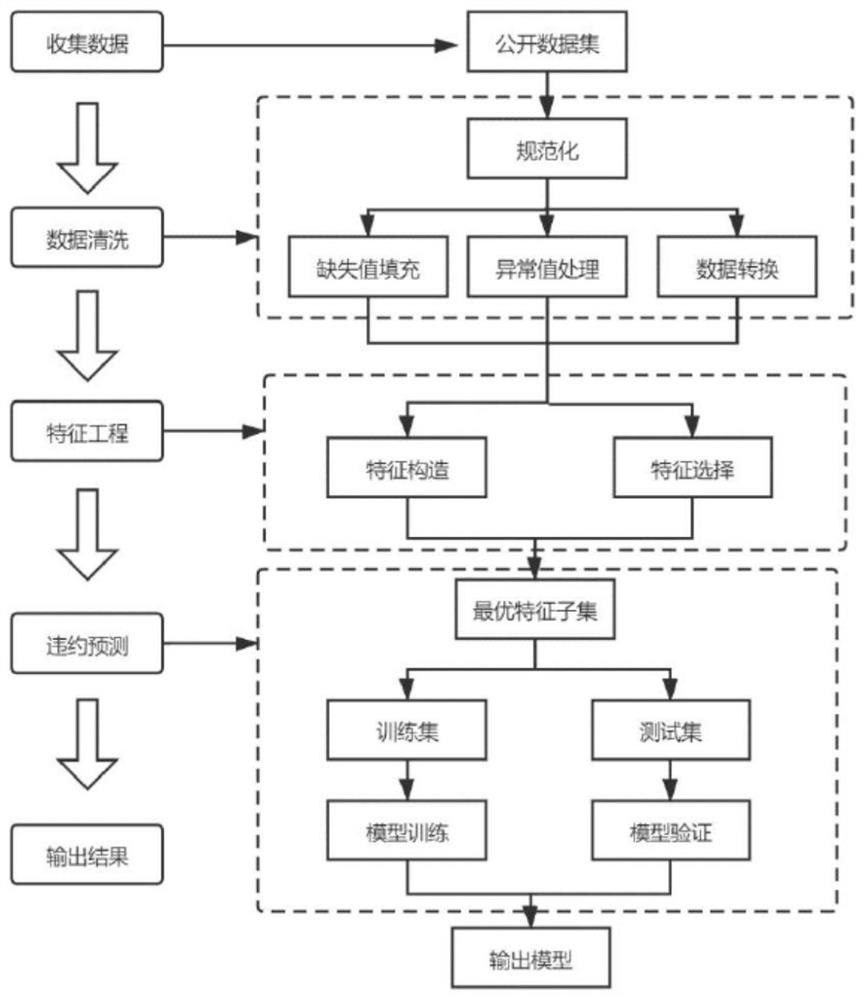

Enterprise default risk assessment method and equipment based on GBDT algorithm and logistic regression model, and medium

PendingCN114519519AIncrease contributionReduce bad debt rateFinanceMachine learningEvaluation resultAlgorithm

The invention discloses a method and equipment for constructing an enterprise default risk assessment model based on a GBDT algorithm and a logistic regression model, and a medium. The method comprises the following steps: acquiring data of a plurality of sample enterprises, integrating and processing the acquired data to obtain standardized data, calculating a WOE value and an IV value of the standardized data, performing variable binning and screening through the WOE value and the IV value, using a GBDT algorithm as a preposition algorithm of a logistic regression model, constructing a new combination feature by the GBDT algorithm, and constructing the new combination feature according to the logistic regression model. And inputting the data to the logistic regression model so as to construct an enterprise default risk assessment model, and finally assessing a to-be-assessed enterprise by the enterprise default risk assessment model to obtain an enterprise default risk assessment result, and identifying an enterprise default risk probability. According to the method, the model entering variables of the logistic regression model are combined by adopting the GBDT algorithm, the variables which contribute more to the model are selected, and meanwhile, the importance of the variables is analyzed, so that the model evaluation result is more reasonable, and the accuracy of model evaluation is effectively improved.

Owner:天元大数据信用管理有限公司

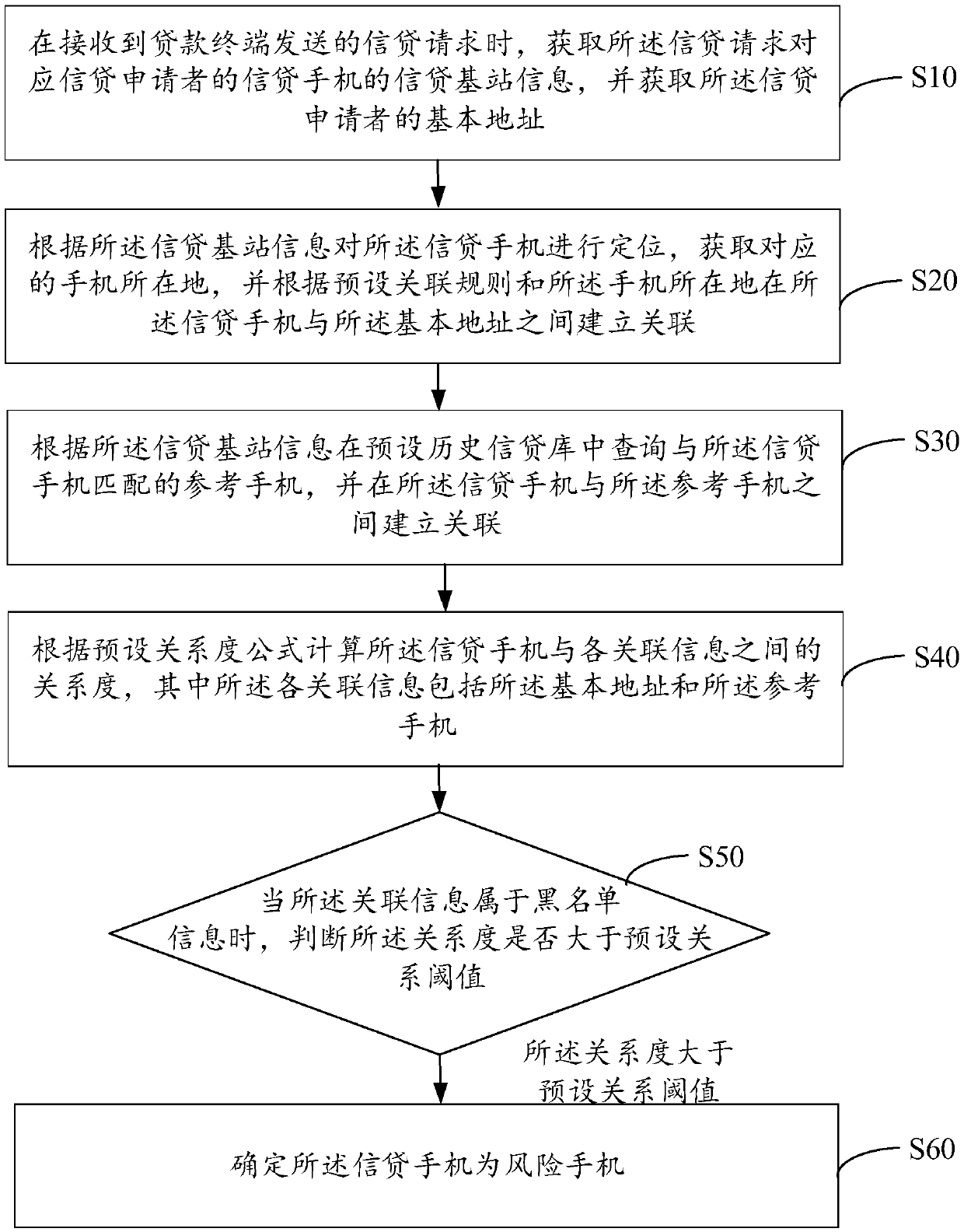

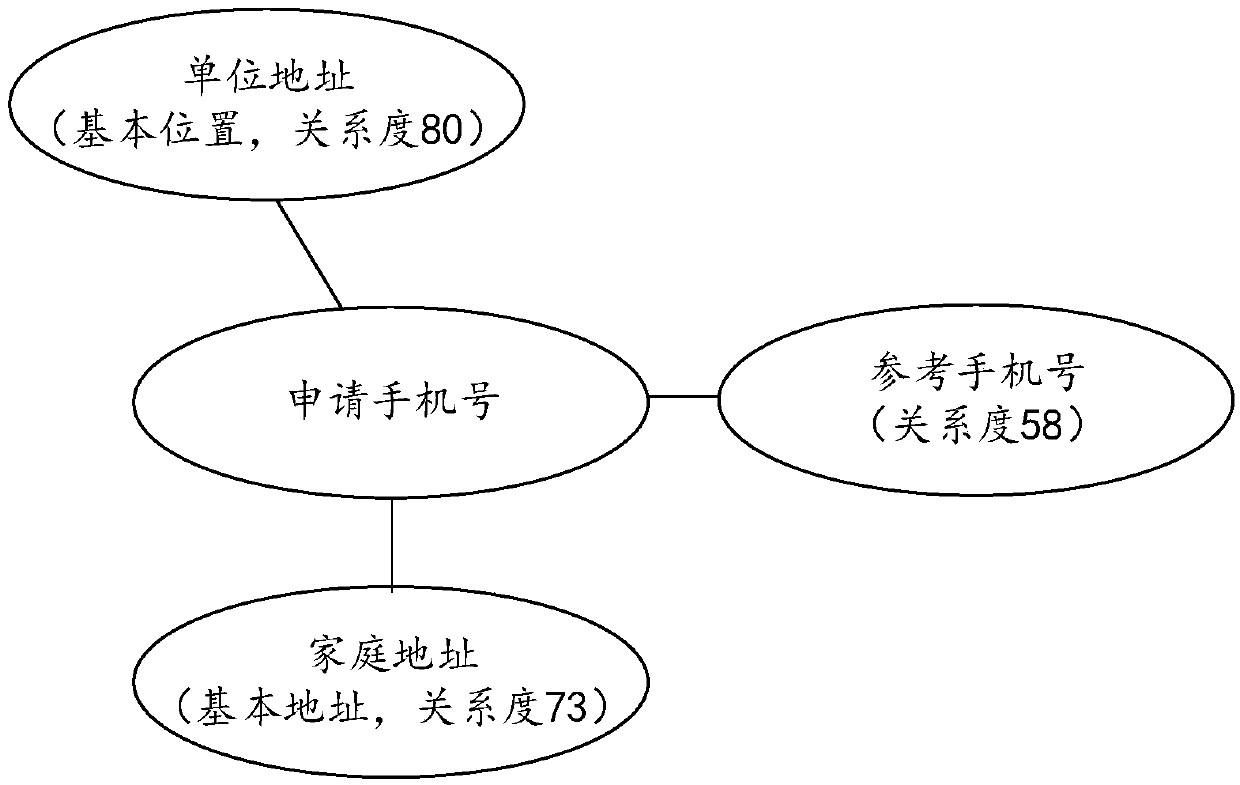

A risk analysis method and device of a mobile phone number, an apparatus and a readable storage medium

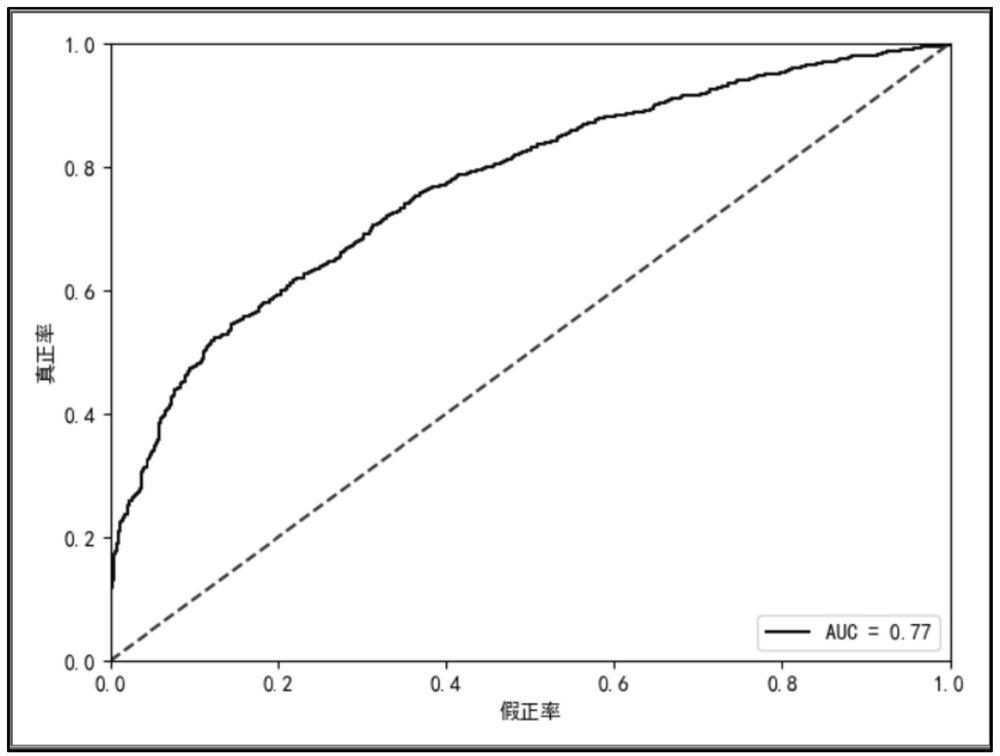

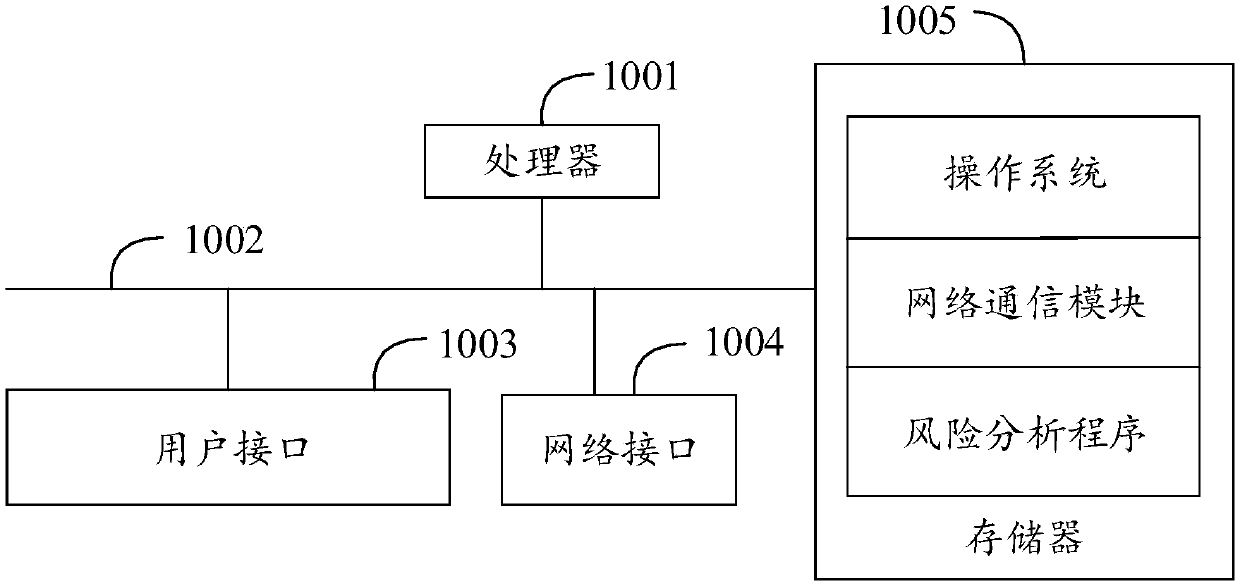

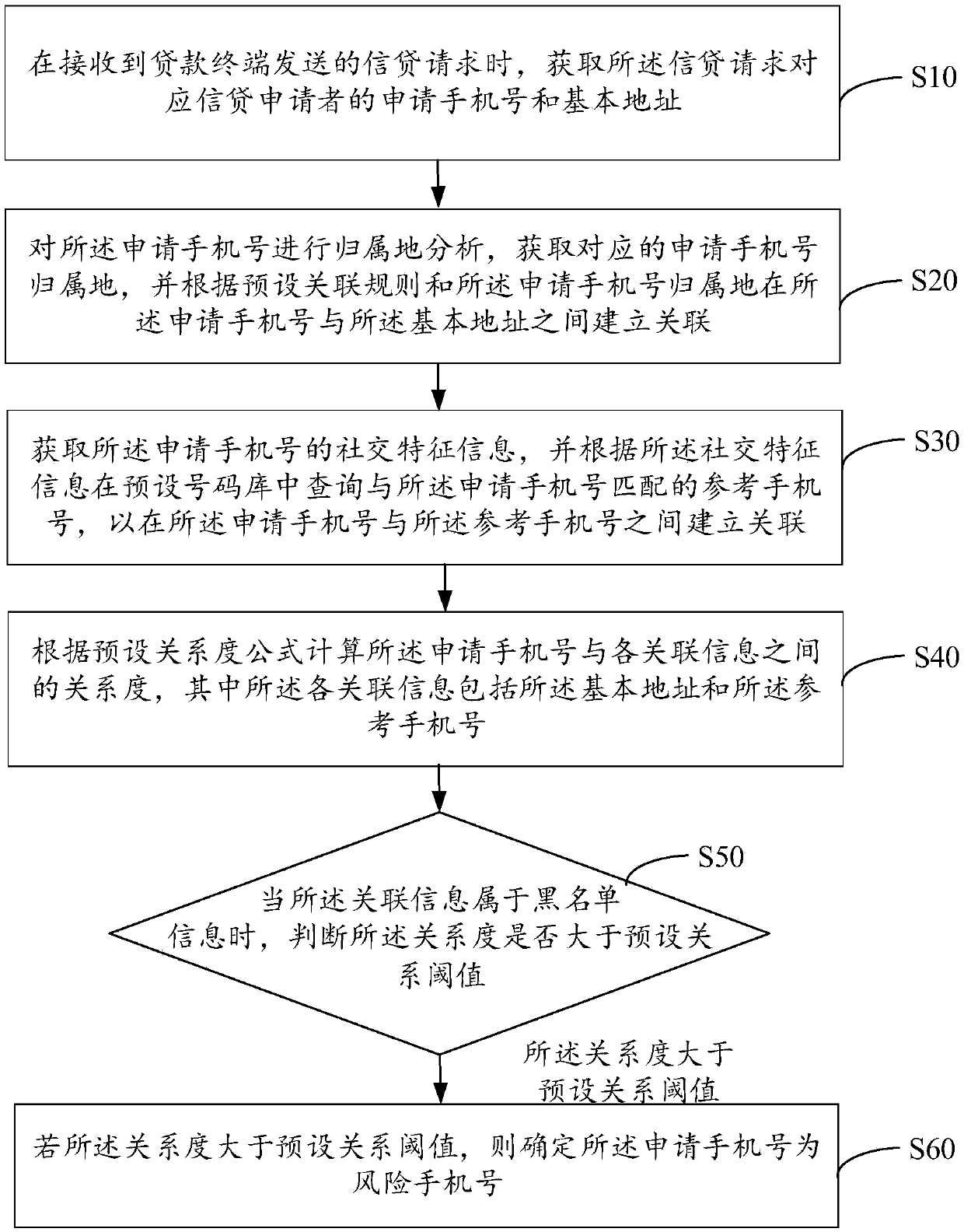

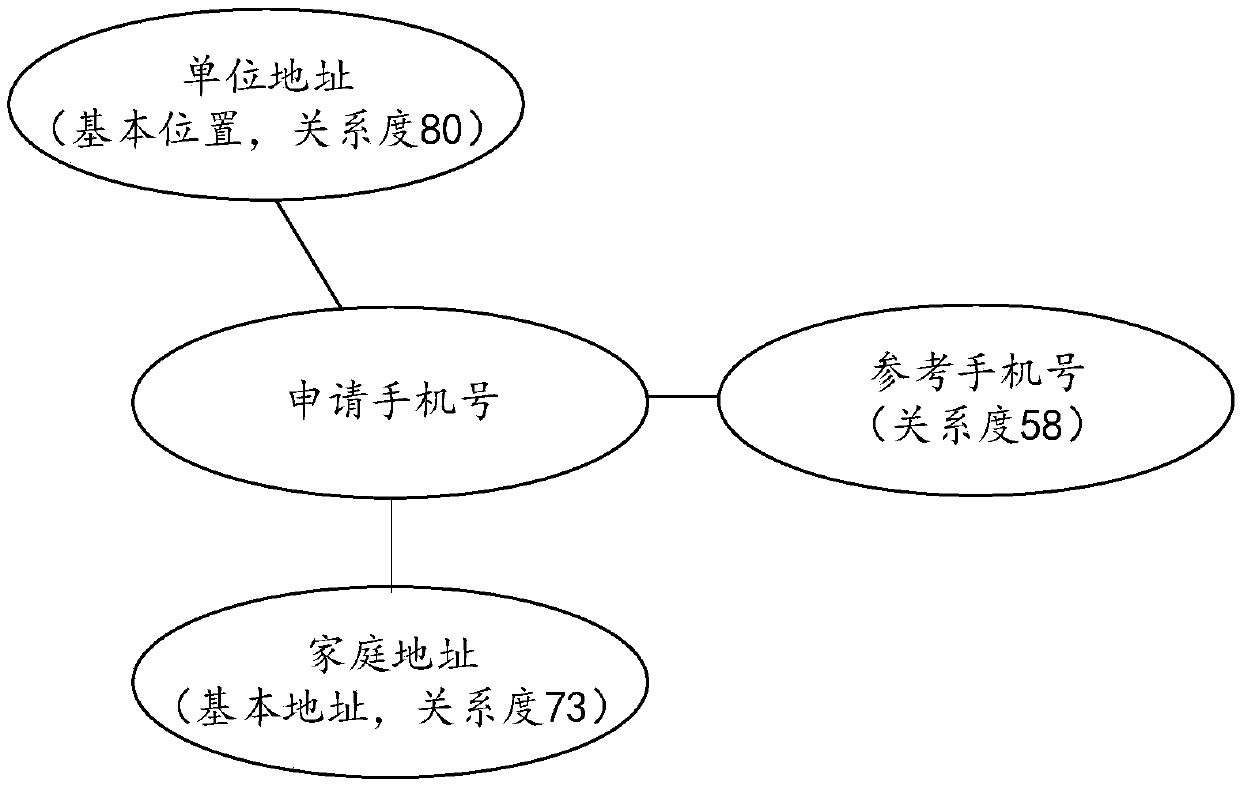

PendingCN109636570AReduce bad debt rateImprove accuracyFinanceCharacter and pattern recognitionRisk profilingAnalysis method

The invention provides a risk analysis method and device of a mobile phone number, an apparatus and a readable storage medium. The mobile phone number of a loan applicant is integrated and associatedwith other information (including the information of the loan applicant and the information of others) in a relationship mode, which is conducive to determining the connection between the mobile phonenumber and other information. the method analyzes and detects the risk of the application mobile phone number according to the processing logic of black dyeing (or gray dyeing), Thus, the potential credit fraud risk is effectively predicted in the way of big data analysis, the accuracy of credit analysis is improved, the potential risk can be more effectively warned, the risk can be discovered and avoided as soon as possible, and the bad debt ratio of loan can be reduced.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

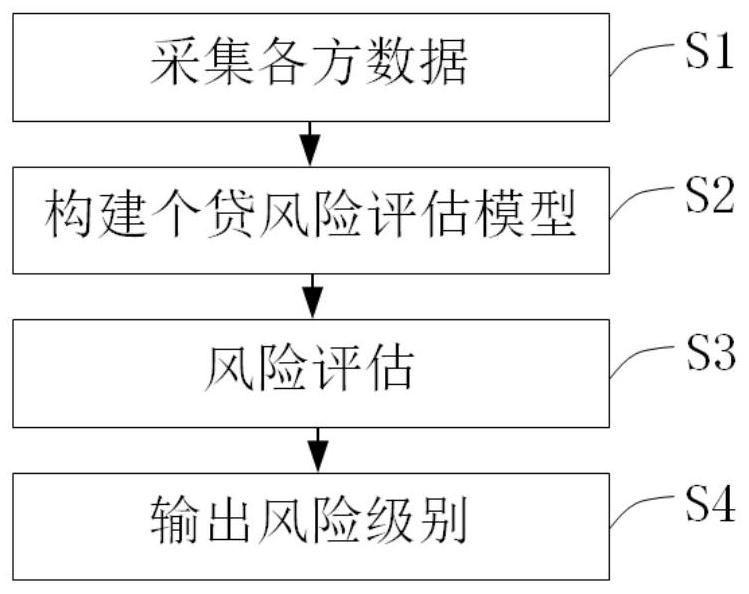

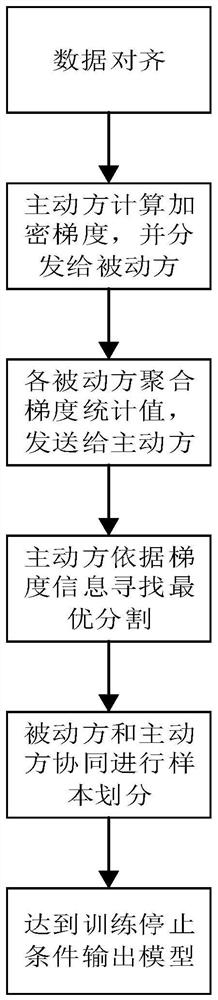

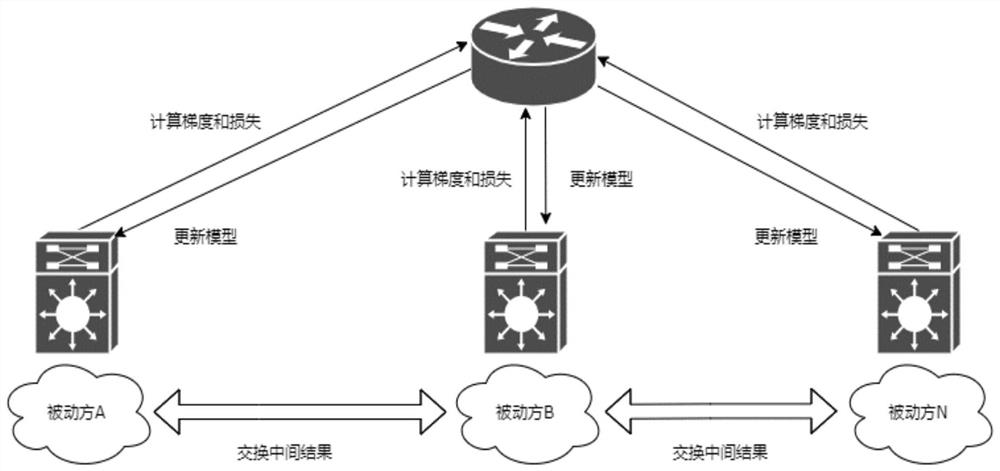

Financial individual loan risk assessment method and device, storage medium and equipment

PendingCN114266645AReduce bad debt rateImprove approval efficiencyFinanceCharacter and pattern recognitionRisk levelUser privacy

The invention provides a financial individual loan risk assessment method and device, a storage medium and equipment, and belongs to the field of risk assessment in artificial intelligence, and the method comprises the steps: collecting data of all parties, constructing an individual loan risk assessment model, carrying out risk assessment, outputting a risk level, classifying users through the individual loan risk assessment model, and carrying out the risk assessment. Outputting a decision report as a risk assessment result as a lending risk assessment basis; according to the method, personal loan risk assessment is carried out by using a federation learning technology based on multi-party data, so that the personal loan bad debt rate is reduced and the personal loan approval efficiency is improved on the premise of ensuring data security and user privacy.

Owner:GRG BAKING EQUIP CO LTD

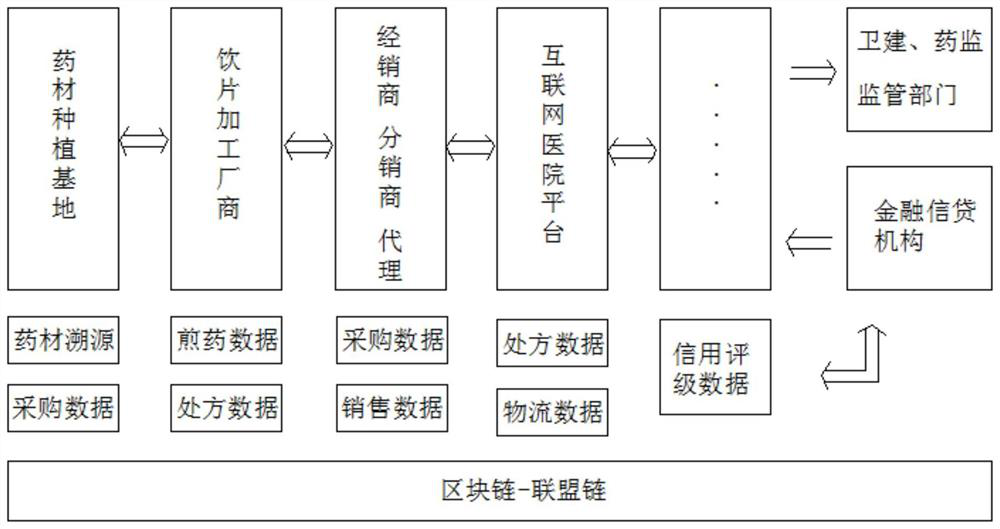

Block chain-based traditional Chinese medicine supply chain industry financial system establishment method

PendingCN113538128AFull circulationReduce bad debt rateFinanceDatabase distribution/replicationBusiness enterpriseBusiness data

The invention provides a block chain-based traditional Chinese medicine supply chain industry financial system establishment method. Upstream and downstream main enterprises in a traditional Chinese medicine supply chain industry are combined, a financial credit institution and an industry supervision department are introduced, an authority framework is established, business generation nodes and processes in traditional Chinese medicine supply chain production are combed, and an alliance chain intelligent contract is complied; related intersection business data systems are combed in upper, middle and lower subject enterprises, the researched and developed block chain smart contract is embedded into a corresponding business system, a credit value is generated according to business data, the business data generated by the upper, middle and lower subjects are verified, authenticated and queried by a financial credit subject and a supervision subject, the TOKEN voucher of the related main enterprise is queried as credit data in the traditional Chinese medicine supply chain industry, the invention provides the method for establishing the traditional Chinese medicine supply chain industry financial system based on the block chain, which can improve the full circulation of funds in the traditional Chinese medicine supply chain industry and reduce the bad debt rate.

Owner:杭州甘之草科技有限公司

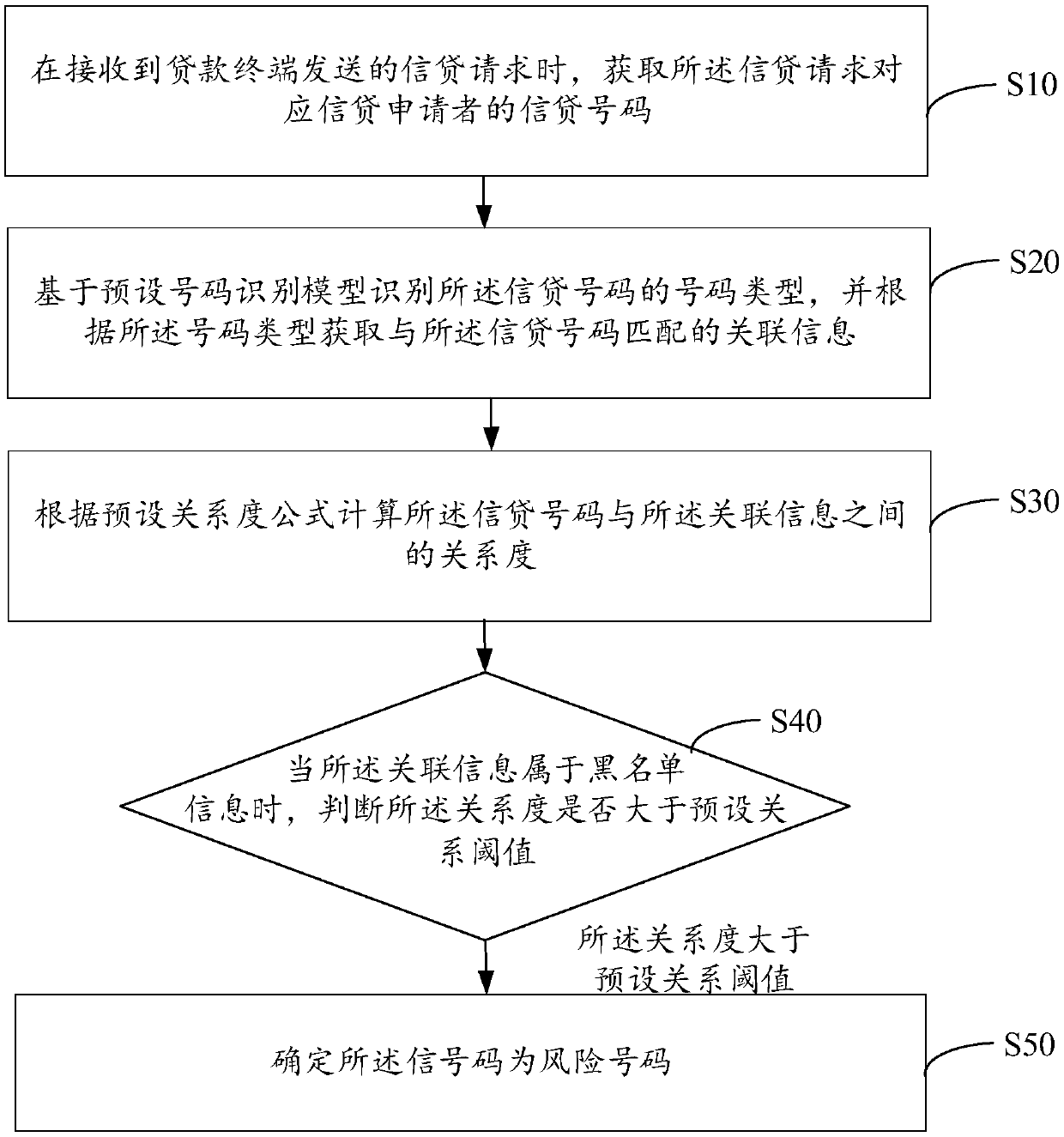

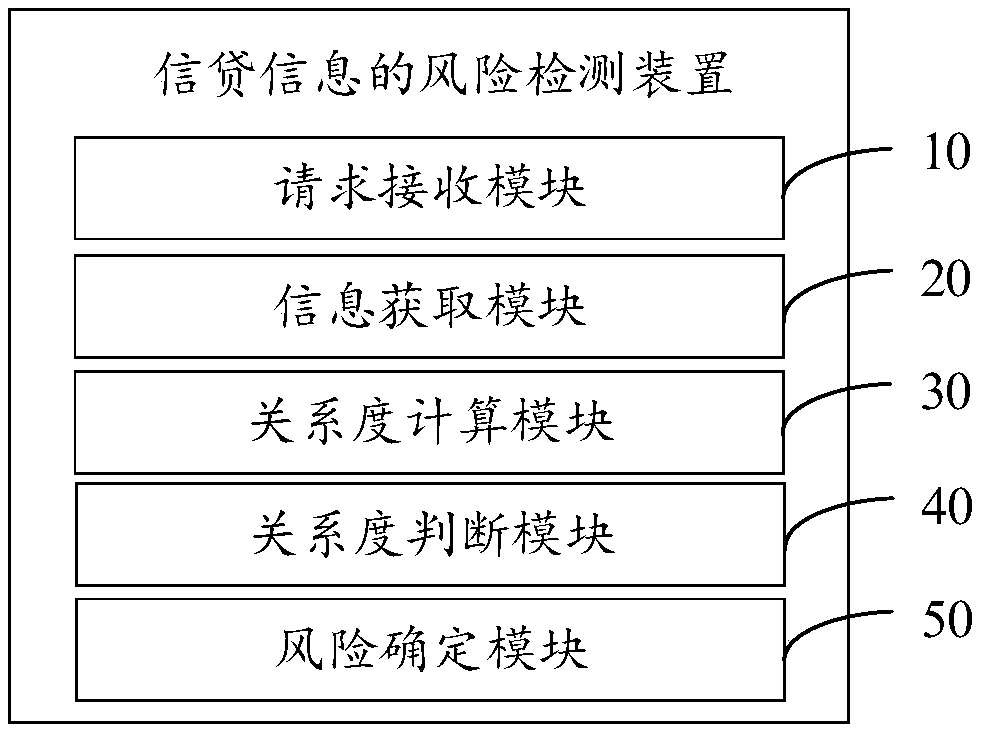

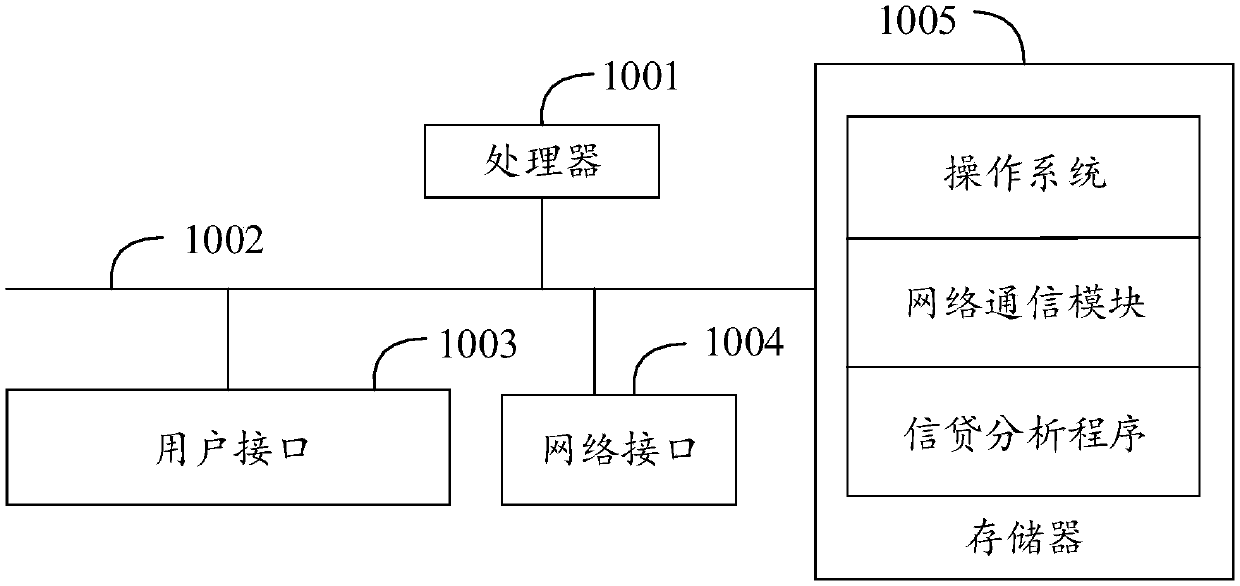

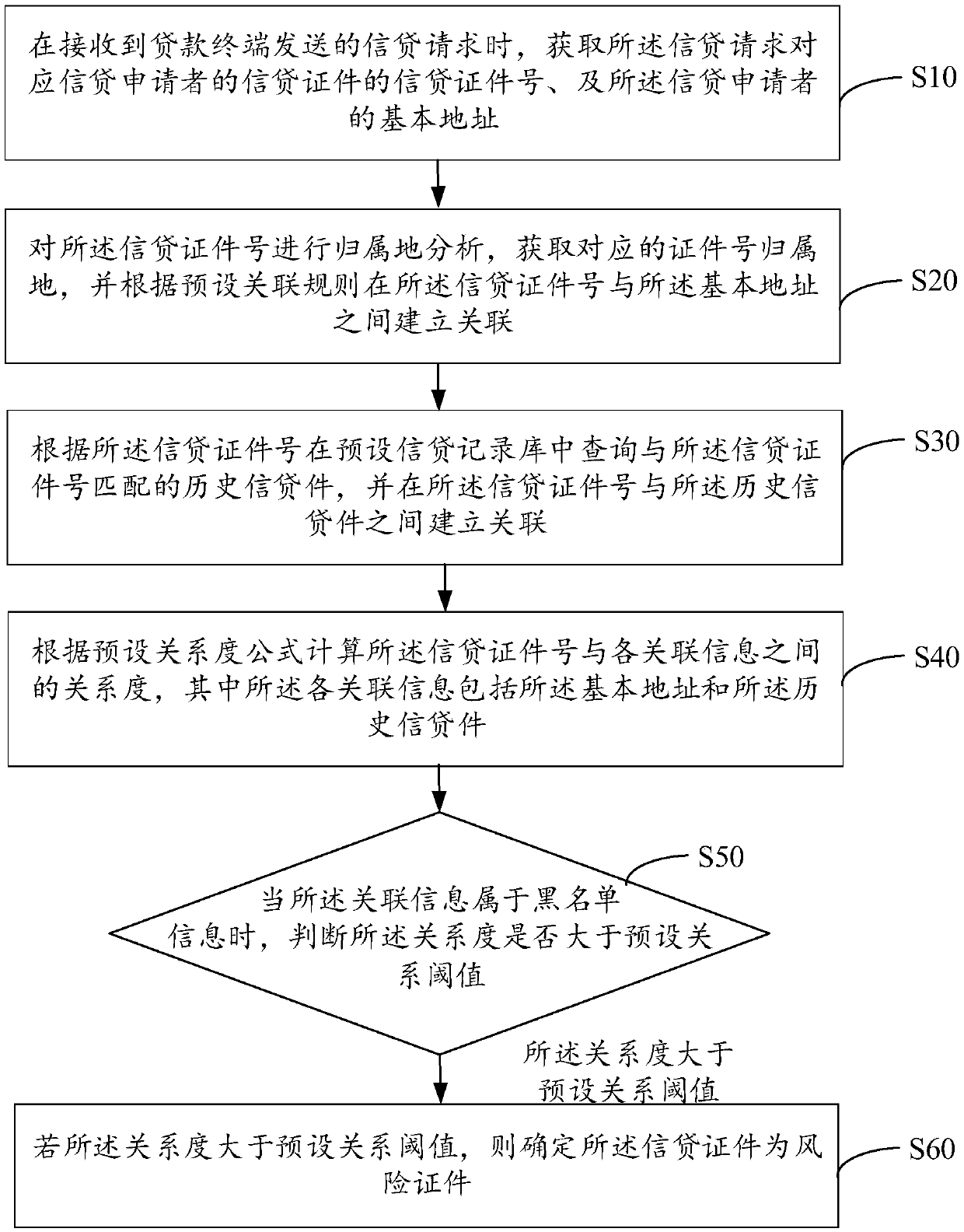

Risk detection method, device, apparatus, and readable storage medium for credit information

ActiveCN109636578AReduce bad debt rateTo offer comfortFinanceHigh level techniquesRisk detectionPotential risk

The invention provides a risk detection method, a device, an apparatus and a readable storage medium for credit information, which can intelligently identify a signal number type provided by a loan applicant through a preset model, thereby facilitating the loan applicant to provide loan data and reducing the examination workload of a risk control personnel. At the same time, integrating and associating loan applicant's credit number with other information in the way of relationship is helpful to determine the relationship between credit number and other information. And the method analyzes anddetects the risk of credit number according to the processing logic of black dyeing (or gray dyeing), Thus, the potential credit fraud risk is effectively predicted in the way of big data analysis, the accuracy of credit analysis is improved, the potential risk can be more effectively warned, the risk can be discovered and avoided as soon as possible, and the bad debt ratio of loan can be reduced.

Owner:PING AN TECH (SHENZHEN) CO LTD

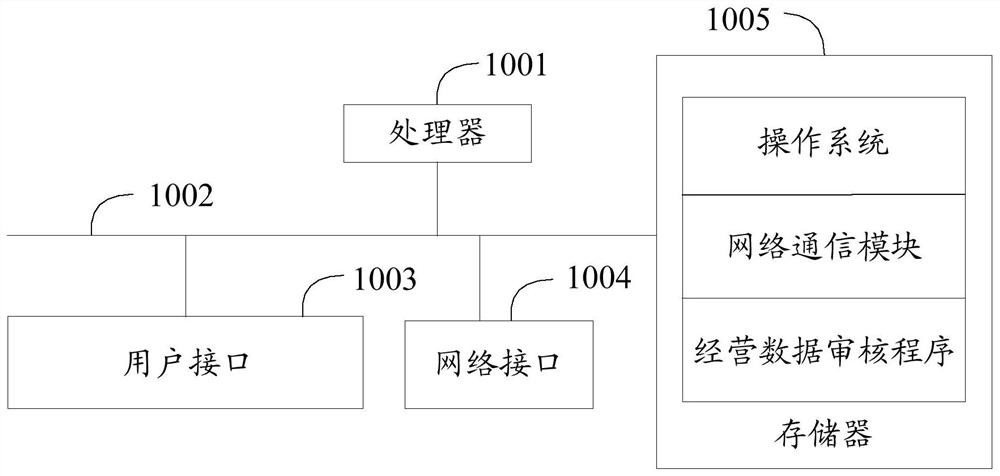

Business data review method, device, equipment, and computer-readable storage medium

The invention discloses a business data review method, which includes: obtaining enterprise sample data, constructing a simulated standard average in a preset coordinate system, and obtaining a simulated confidence interval based on the simulated standard average; when receiving a loan request, Obtain the enterprise operating data of the borrowing enterprise corresponding to the loan request, and fit the corresponding enterprise operating line in the preset coordinate system; compare the enterprise operating line with the simulated confidence interval, and judge whether the enterprise operating data abnormal. The invention also discloses a management data checking device, equipment and computer-readable storage medium. The invention learns large-scale enterprise data by means of machine learning, fits an average line and simulated confidence interval of enterprise operation, and then reviews the operating data of the borrowing enterprise through the average line and simulated confidence interval, thereby judging the borrowing enterprise Whether the business data of the company is authentic and credible, and identify the fraudulent behavior of the borrowing company.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

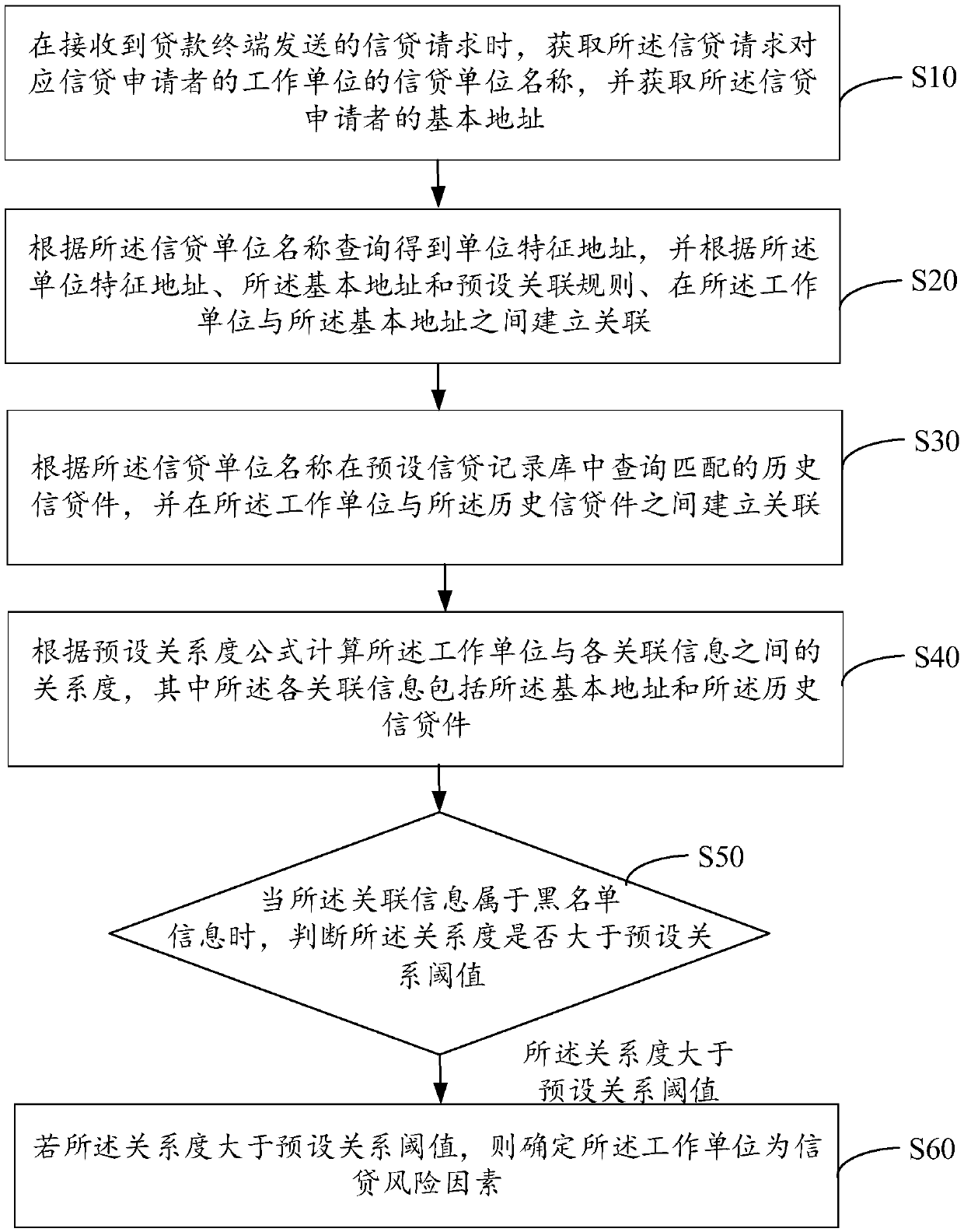

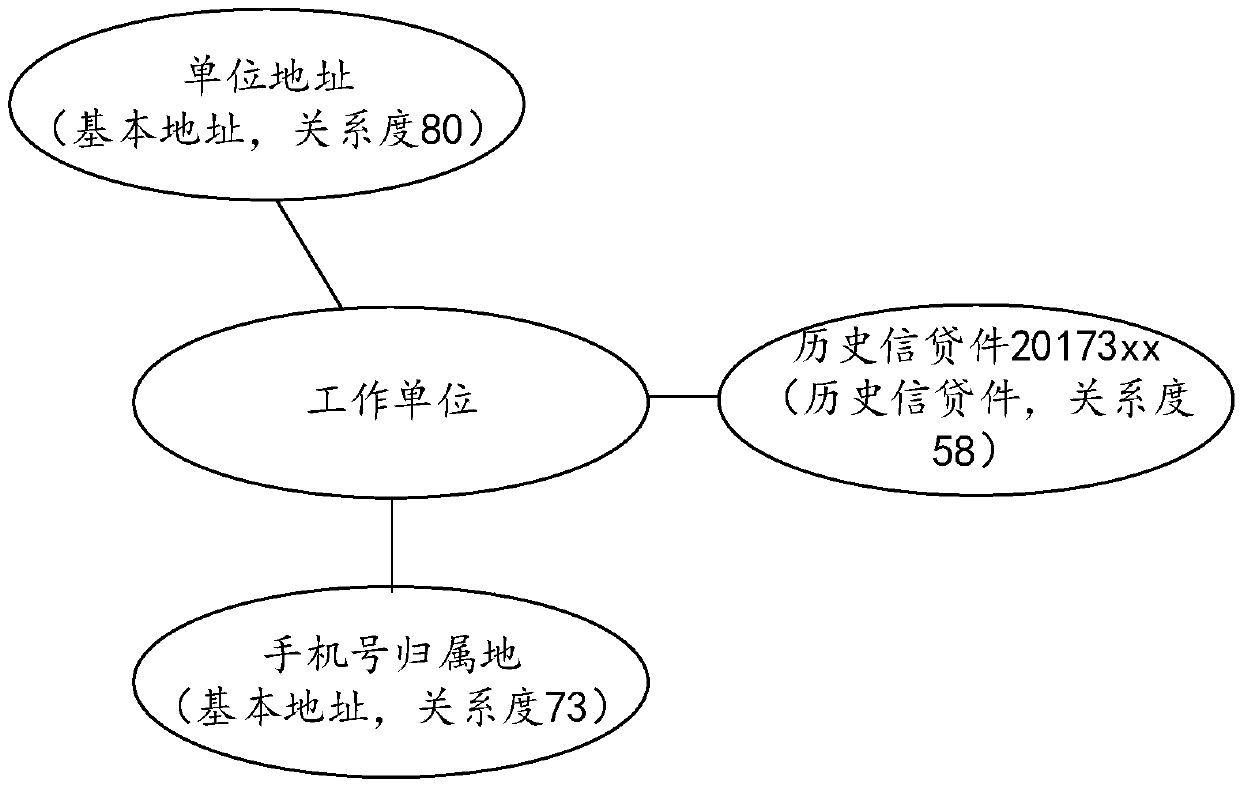

Work unit information risk detection method and device, equipment and storage medium

The invention provides a risk detection method for work unit information. According to the device, the equipment and the storage medium, from a unit name, working unit information provided by a loan applicant is integrated and associated with other information (including information of the loan applicant and historical credit information) in a'relation 'mode, and the contact between the working unit information and the other information can be easily determined; The risk of the working unit information is analyzed and detected by combining the processing logic of black dyeing (or grey dyeing);Therefore, the potential credit fraud risk is effectively predicted in a big data association analysis processing mode, the accuracy of credit risk detection is improved, the potential risk can be more effectively early warned, the risk can be discovered and avoided as soon as possible, and the loan bad account rate is reduced.

Owner:PING AN TECH (SHENZHEN) CO LTD

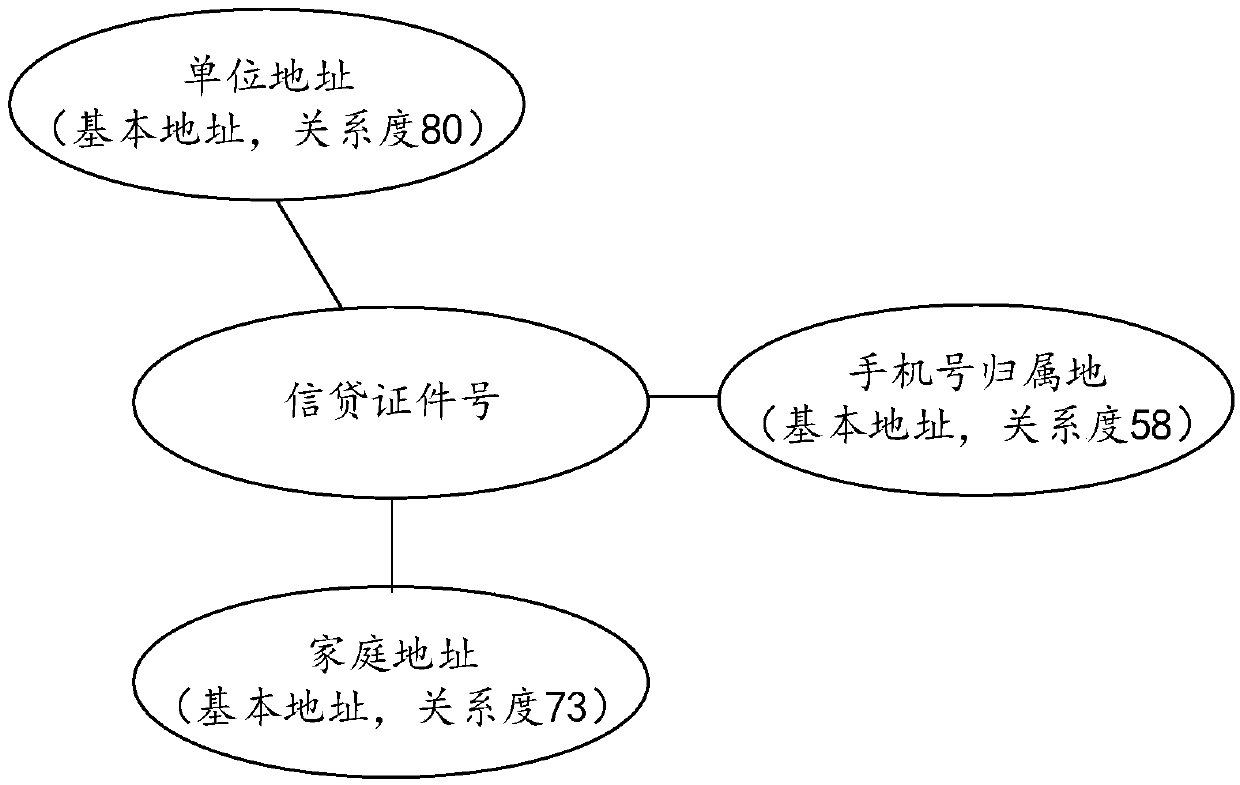

Credit analysis method, device, apparatus, and readable storage medium

The invention provides a credit analysis method and device, an apparatus and a readable storage medium. The invention integrates and associates the credit certificate number of a loan applicant with other information (including the information of the loan applicant and the historical credit information) in a relation mode, thereby facilitating the determination of the relationship between the credit certificate and other information. Combined with the black (or gray) processing logic, the method analyzes and detects the risk of credit documents, so as to effectively predict the risk of creditfraud in the form of big data analysis, improve the accuracy of credit analysis, and be able to more effectively early warning of potential risks, can be found as soon as possible and avoid risks andreduce the bad debt rate of loans.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

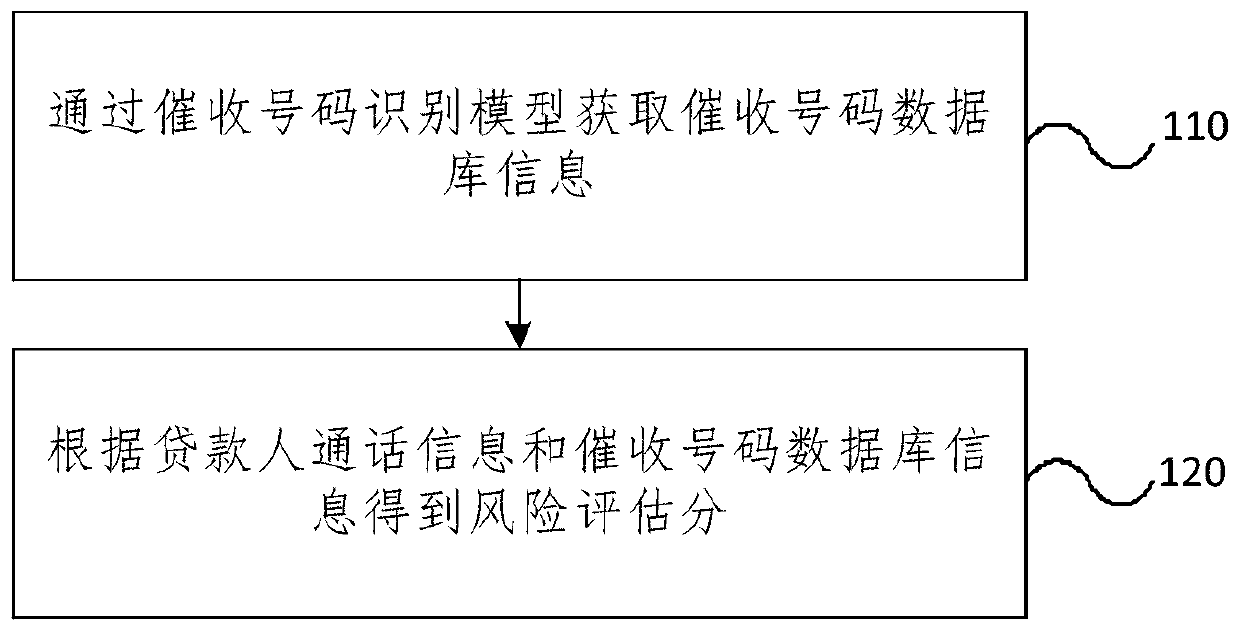

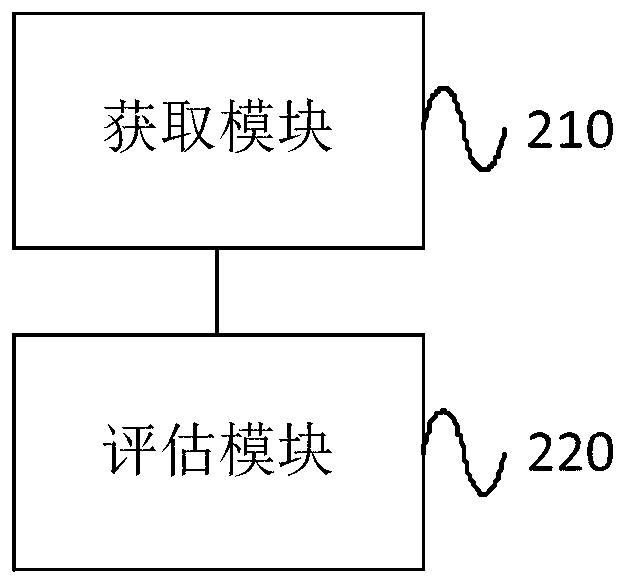

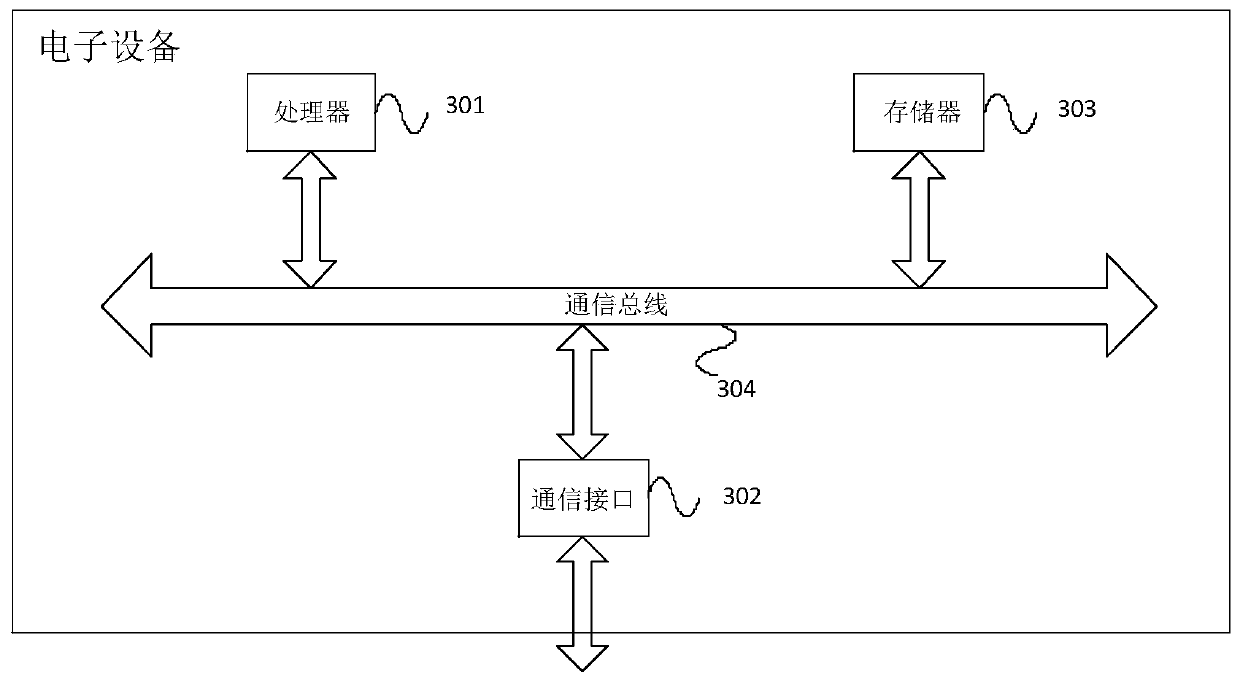

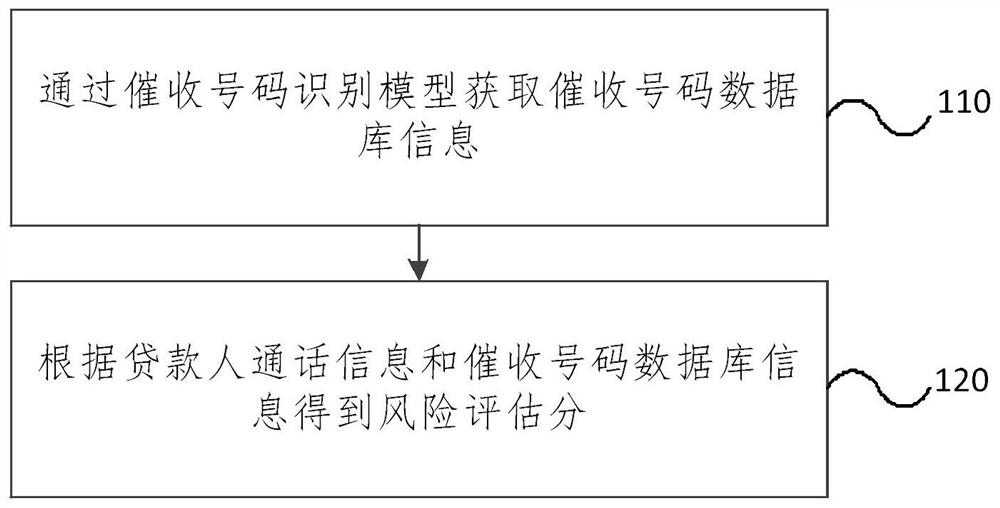

A pre-loan risk monitoring method and device based on collection

The embodiment of the invention provides a pre-loan risk monitoring method and device based on collection. The method comprises the steps that acquiring collection number database information througha collection number recognition model; and obtaining a risk assessment score according to the loan conversation information and the collection number database information. A collection number and a collection address are acquired through a crawler technology, nearby operator base station information is matched according to the collection address, so that a collection number sample database is determined, a collection number recognition model is finally obtained through feature attribute information, and collection number library information can be obtained; the final risk assessment score isobtained according to the number information of the collector in the communication information of the loan, the pre-loan risk monitoring based on collection is innovatively carried out on the loan according to the collection condition of the loan, the pre-loan risk monitoring capability is practically enhanced, and the bad account rate is reduced.

Owner:BEIJING MATARNET TECH

A collection-based pre-loan risk monitoring method and device

The embodiment of the present invention provides a pre-loan risk monitoring method and device based on collection. The method includes: obtaining the collection number database information through the collection number identification model; obtaining the risk assessment score according to the call information of the lender and the collection number database information. Obtain the collection number and collection address through crawler technology, and then match the nearby operator base station information according to the collection address, so as to determine the collection number sample database, and then obtain the collection number identification model through the feature attribute information, so as to obtain the collection number library information The final risk assessment score is obtained according to the collector number information in the call information of the lender. The embodiment of the present invention innovatively monitors the lender's pre-loan risk based on debt collection through the situation that the lender is being collected. Effectively strengthen the pre-loan risk monitoring capability and reduce the bad debt rate.

Owner:BEIJING MATARNET TECH

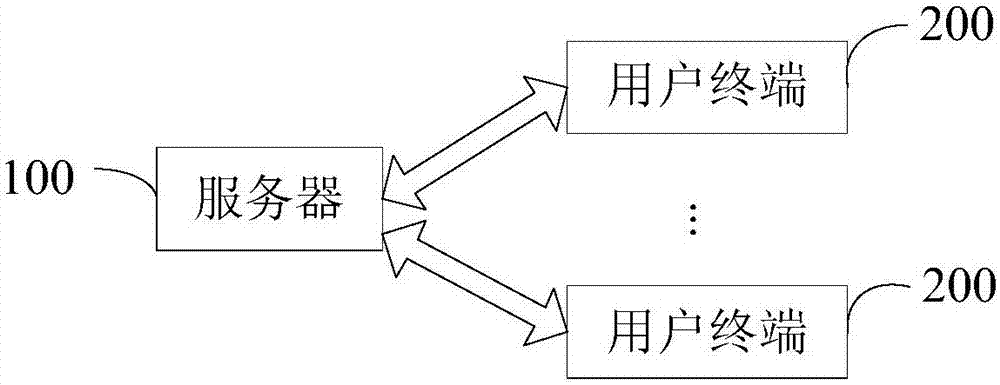

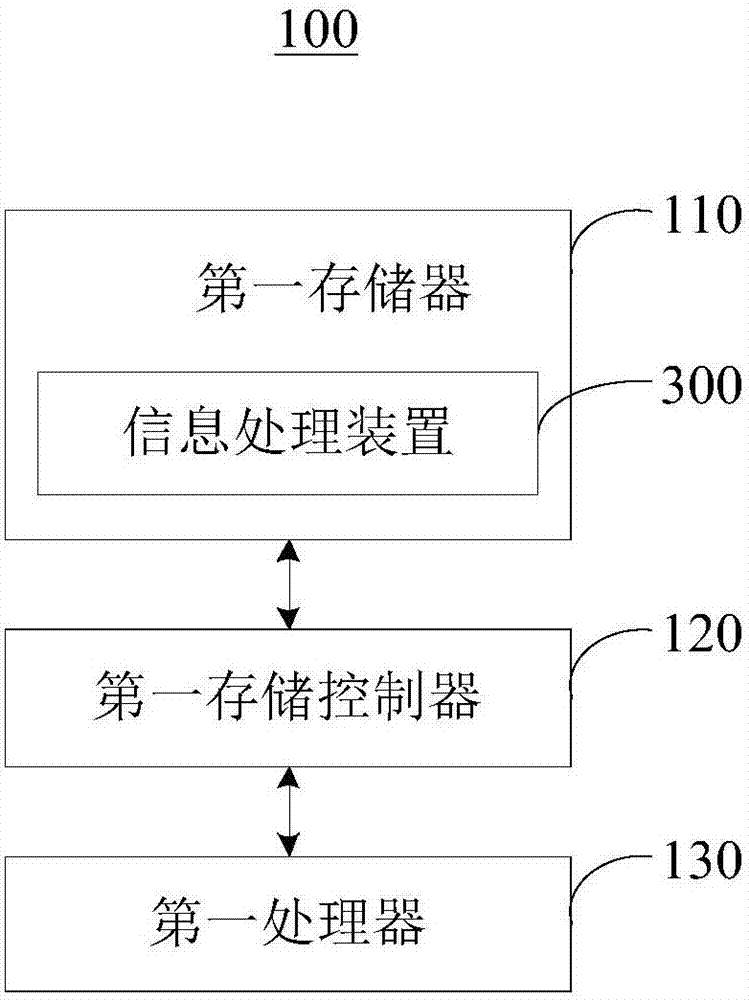

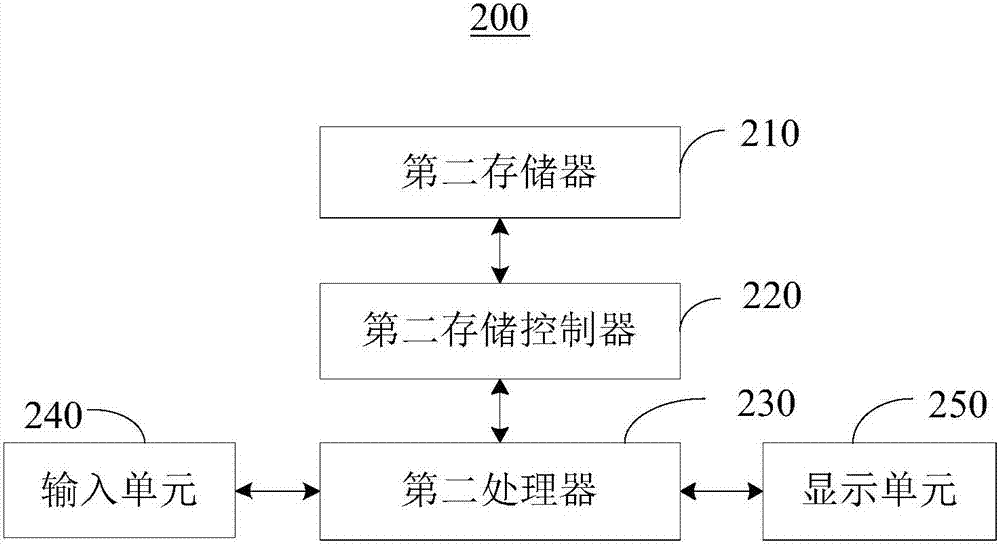

Information processing method, device, server, and computer-readable storage medium

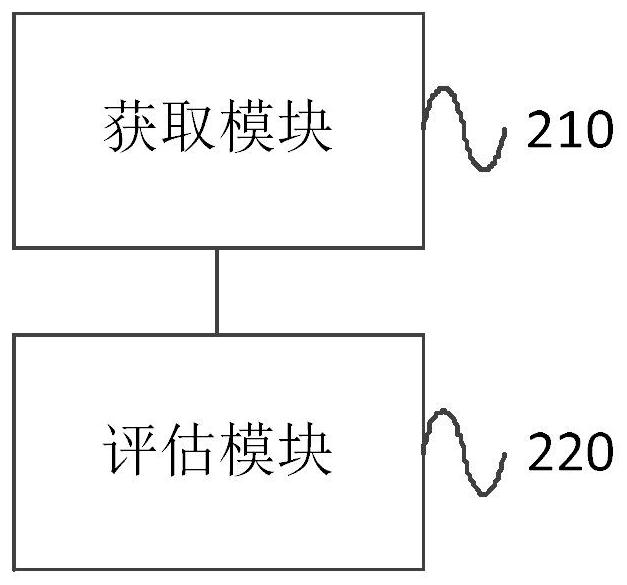

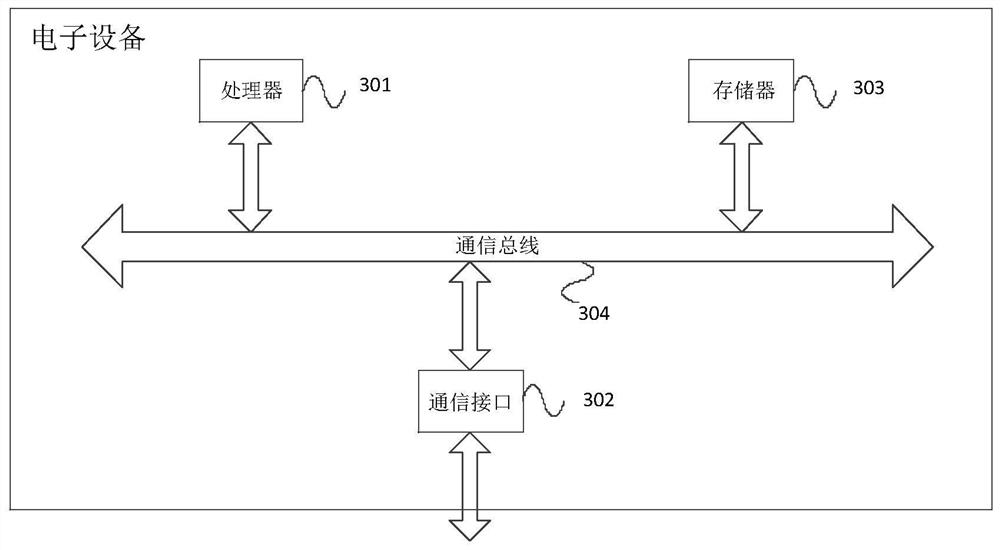

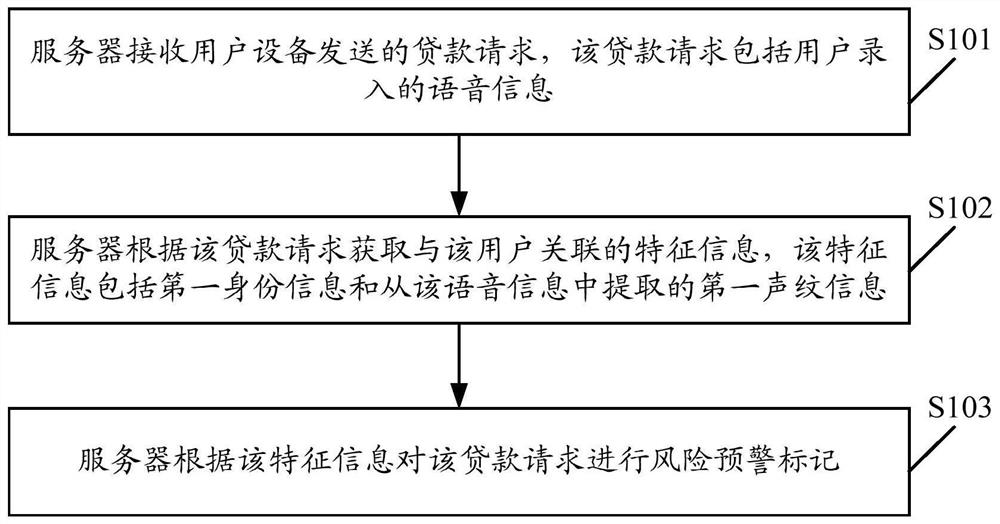

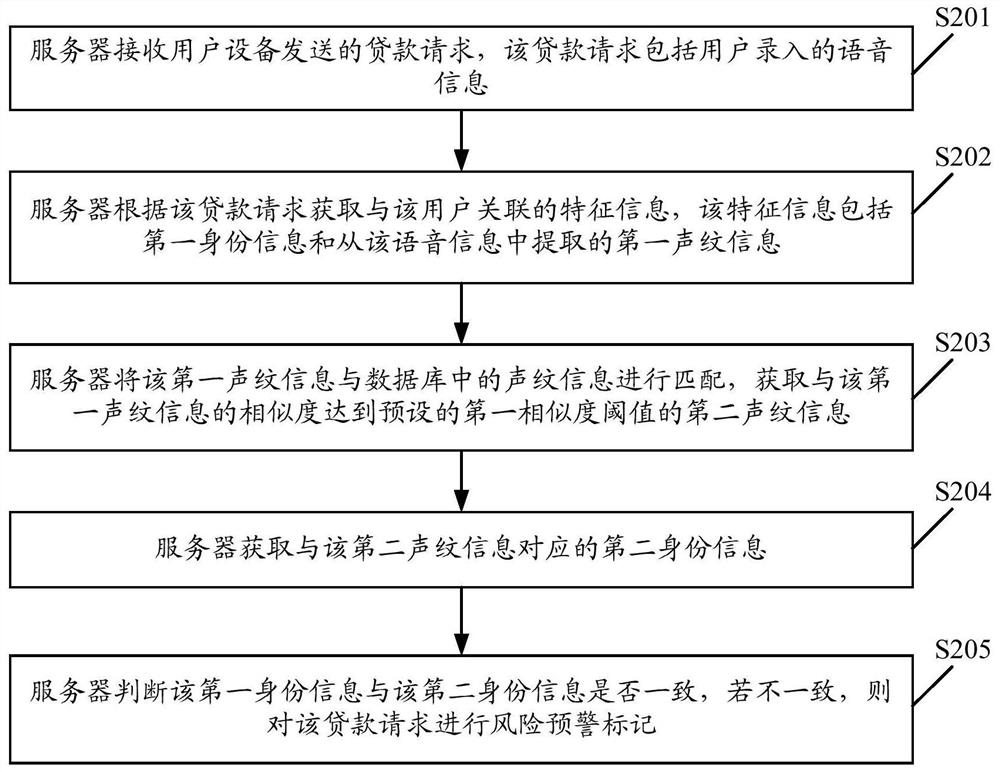

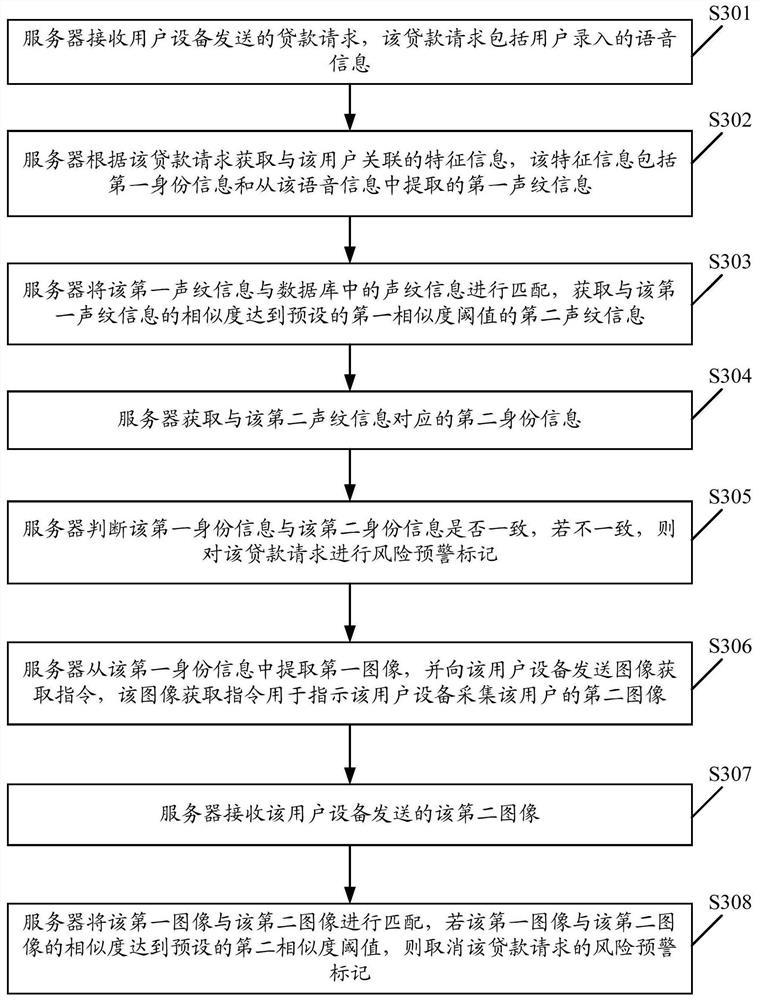

ActiveCN107977776BAccurate Risk JudgmentAvoid Loan SituationsFinanceSpeech analysisInformation processingUser device

Owner:SIMPLECREDIT MICRO LENDING CO LTD

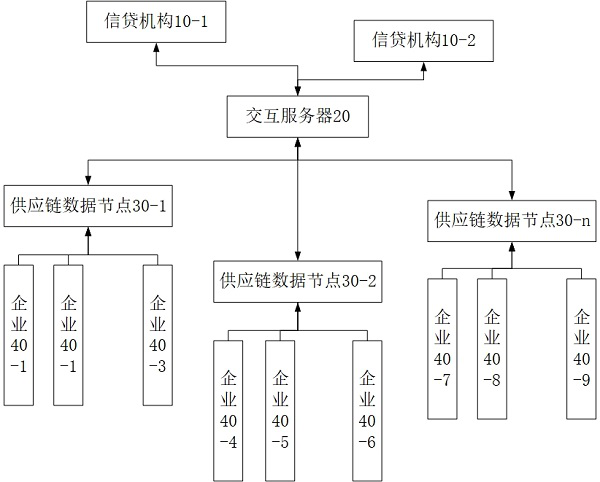

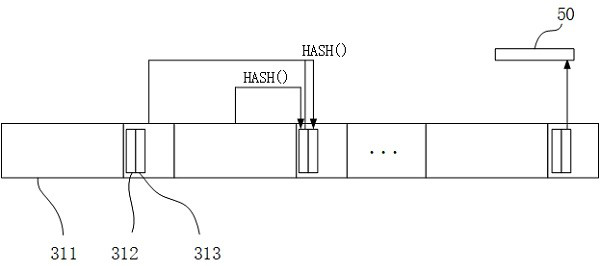

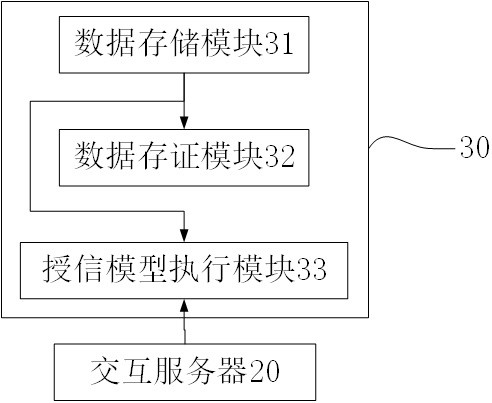

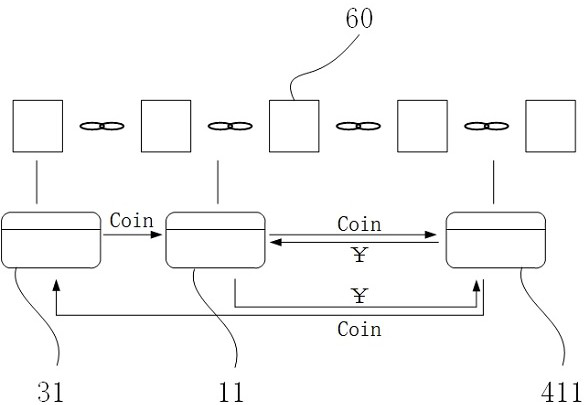

Supply chain financial platform based on credit extension model

PendingCN113487402APrivacy protectionGuarantee authenticityFinanceDatabase distribution/replicationBusiness enterpriseBusiness data

The invention relates to the technical field of supply chain finance, in particular to a credit extension model-based supply chain finance platform, which comprises a plurality of supply chain data nodes and an interaction server, and is characterized in that the supply chain data nodes are connected with a plurality of supply chain enterprises; the supply chain data node runs a data storage module, a data evidence storage module and a credit extension model execution module, the data storage module stores qualification data, mortgage asset data and business data of a supply chain enterprise, and the credit extension model execution module inputs the business data of the supply chain enterprise into a credit extension model; and the interaction server carries out data interaction with the credit institution, receives the credit extension model submitted by the credit institution, sends the credit extension model to the supply chain data node connected with the loan target supply chain enterprise for execution, obtains a credit line, and carries out credit business according to the credit line. The method has the substantial effects that the privacy of supply chain enterprises is effectively protected, the authenticity of credit data is ensured, fund circulation is promoted, and the bad debt rate is reduced.

Owner:浙江数秦科技有限公司

Risk analysis method, device, apparatus, and readable storage medium

PendingCN109636571AReduce bad debt rateGood for contactFinanceLocation information based serviceDyeingPotential risk

The invention provides a risk analysis method, a device, an apparatus and a readable storage medium. The invention integrates and associates the credit mobile phone of a loan applicant with other information (including the information of the loan applicant and the information of others) in a relationship mode, which is conducive to determining the relationship between the credit mobile phone and other information. the method analyzes and detects the risk of credit mobile phone with the processing logic of black dyeing (or gray dyeing), Thus, the potential credit fraud risk is effectively predicted in the way of big data analysis, the accuracy of the credit risk analysis is improved, the potential risk can be more effectively warned, the risk can be discovered and avoided as soon as possible, and the bad debt ratio of loan can be reduced.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

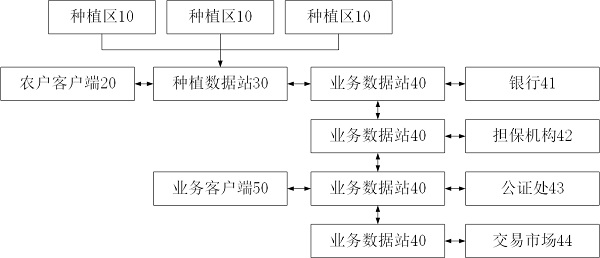

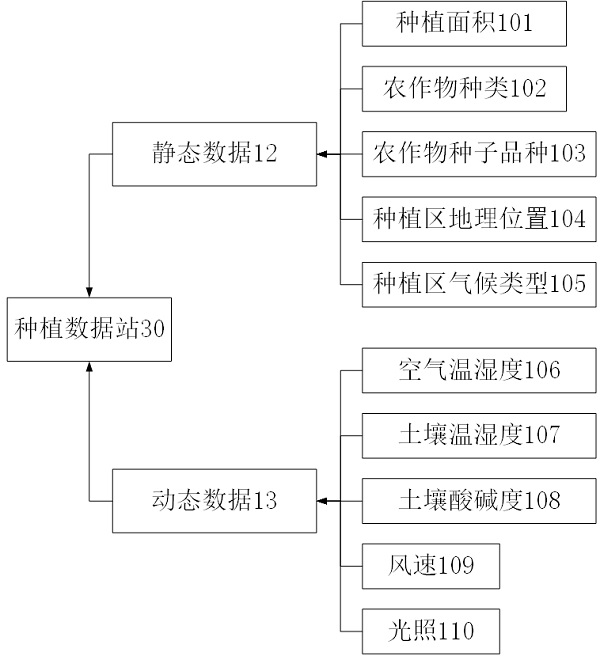

Agricultural credit financing guarantee service platform based on block chain

PendingCN113487404AGuarantee authenticityImprove securityFinanceDatabase distribution/replicationBusiness dataCredit limit

The invention relates to the technical field of block chains, in particular to an agricultural credit financing guarantee service platform based on a block chain, and the platform comprises a plurality of planting data stations which are accessed to planting areas of a plurality of farmers; a plurality of business data stations which are respectively accessed to banks, guarantee institutions, notary offices and transaction markets; peasant household client, wherein a peasant household submits a loan application and a guarantee application to the planting data station through the peasant household client, and the planting data station forwards the loan application and the guarantee application to the business data stations corresponding to the bank and the guarantee mechanism respectively; a business client, wherein the input of the credit model is the planting data and the business data of the farmers, the output of the credit model is the credit limit, the input of the guarantee model is the planting data of the farmers, and the output of the guarantee model is the guarantee limit. The method has the substantive effects that the authenticity of the data is ensured through block chain evidence storage, strict and unified organization is not needed, and funds can quickly and accurately enter agricultural production.

Owner:浙江数秦科技有限公司

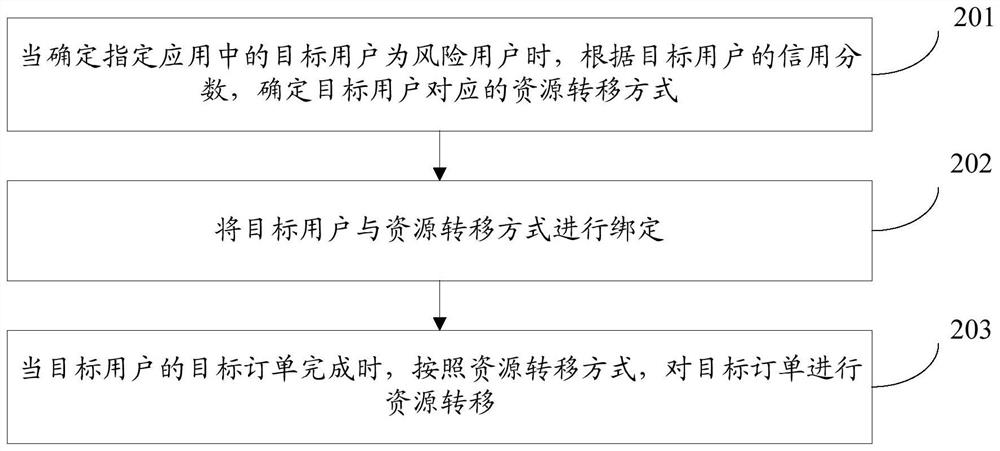

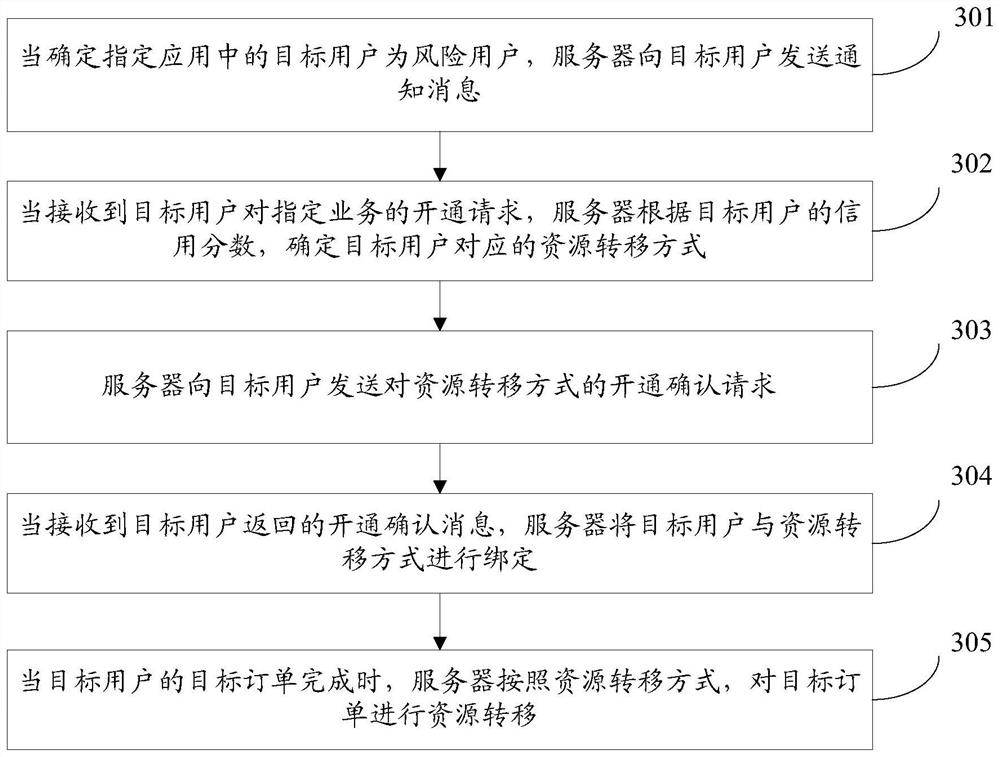

Order processing method and device, server and computer readable storage medium

PendingCN113361732ADoes not affect user experienceGuarantee continuous developmentReservationsPayment schemes/modelsOrder processingData mining

The invention provides an order processing method and device, a server and a computer readable storage medium, and belongs to the technical field of Internet. The method comprises the following steps: when it is determined that a target user in a specified application is a risk user, determining a resource transfer mode corresponding to the target user according to a credit score of the target user, and determining the credit score according to historical resource transfer behavior data of the target user; binding the target user with the resource transfer mode; and when the target order of the target user is completed, performing resource transfer on the target order according to the resource transfer mode. According to the credit score of the target user, the resource transfer mode corresponding to the credit score is selected, and the target order of the target user is processed, so that the payment risk of the target user is reduced, the bad debt rate is reduced, and the sustainable development of the online car-hailing service is ensured.

Owner:BEIJING SANKUAI ONLINE TECH CO LTD

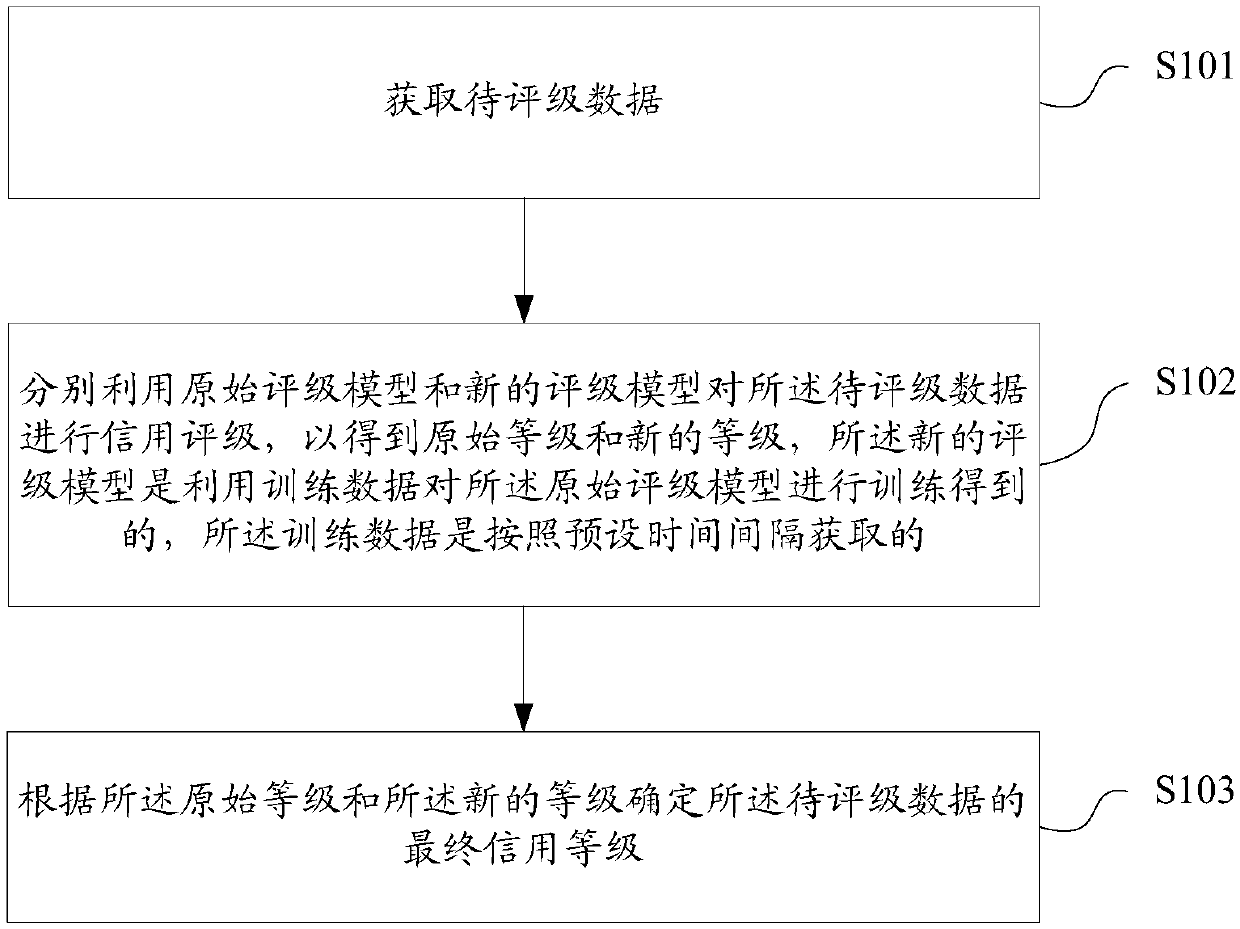

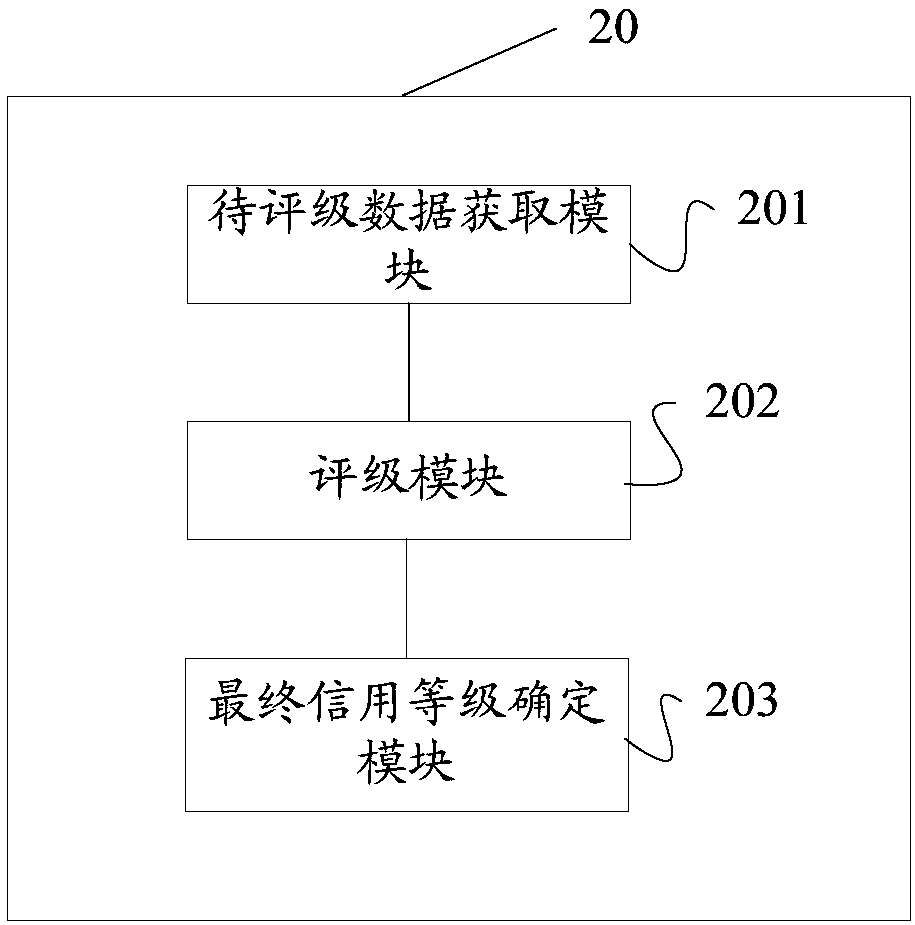

Credit rating method and device, computer readable storage medium and terminal

Owner:上海麦子资产管理集团有限公司

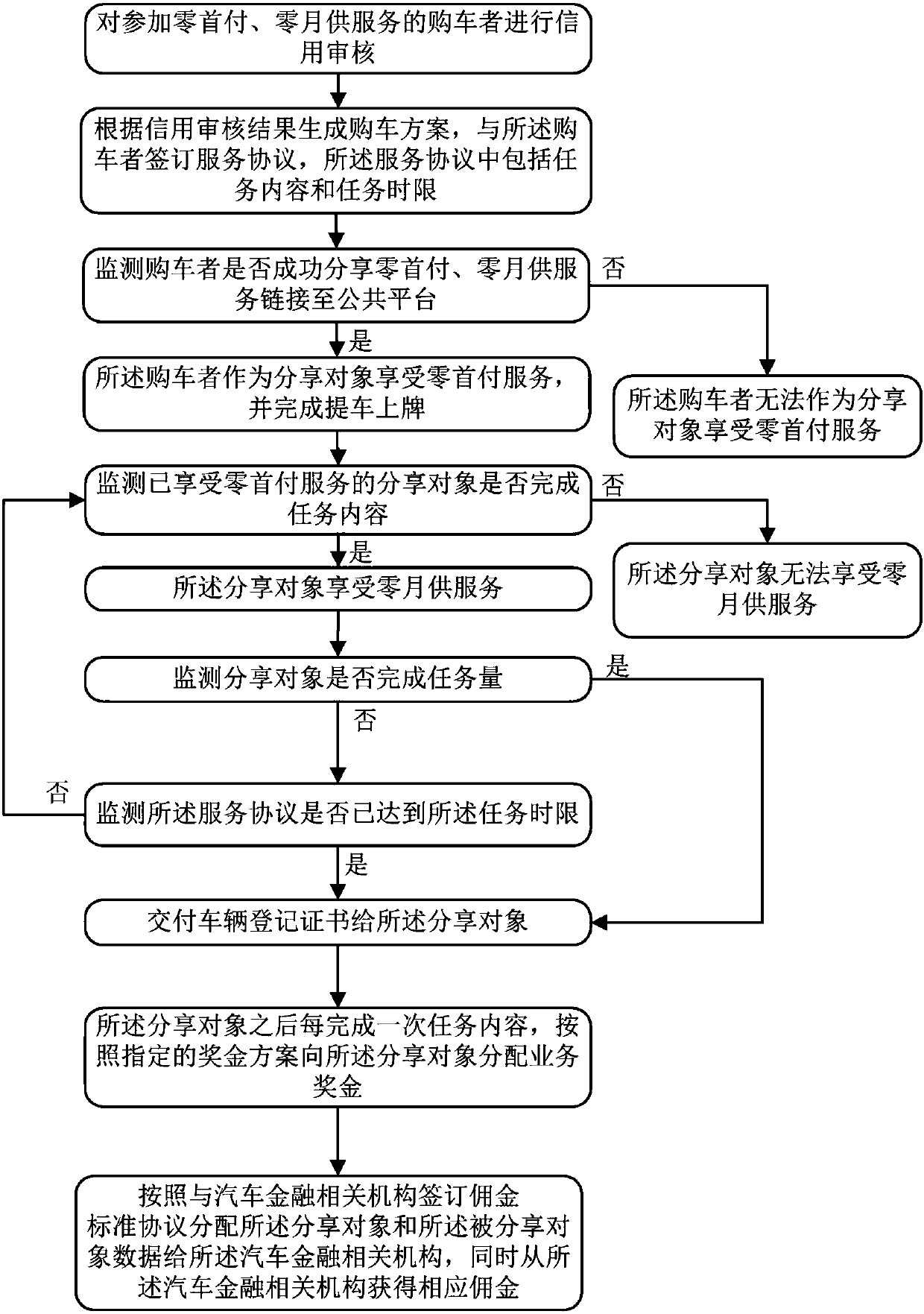

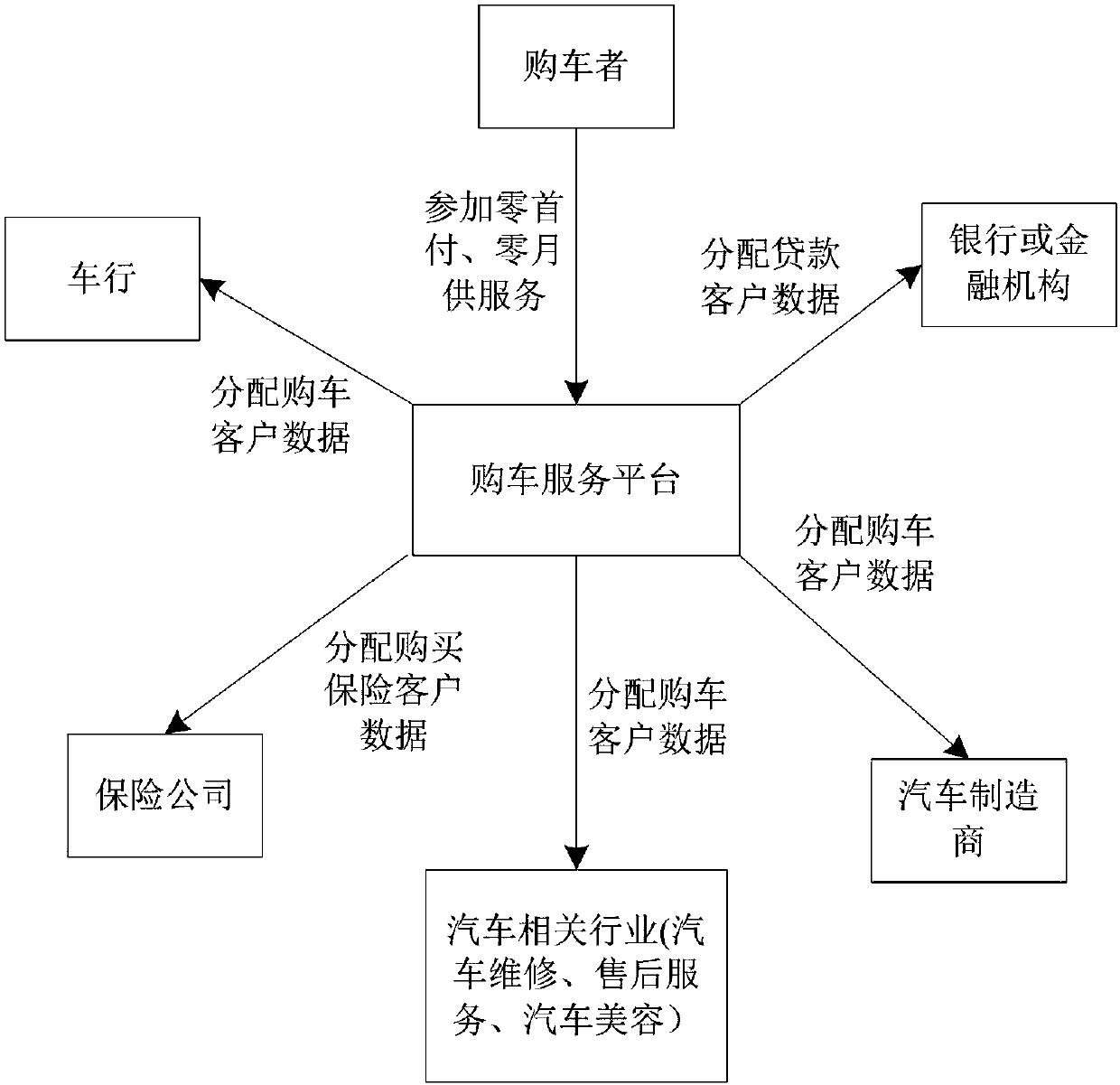

Zero down payment zero monthly installment payment automobile purchase method based on Internet of things

InactiveCN107909364AReduce car loan leverageReduce the pressure on the car supplyDiscounts/incentivesFinanceTask completionNew energy

The invention discloses a zero down payment zero monthly installment payment automobile purchase method based on the Internet of things. After zero down payment automobile purchase, a purchaser is locked and converted into a sharing object, zero down payment business is shared in the same way, and zero monthly installment payment is realized after task completion. The method is advantaged in thatdeposited automobile purchase user big data can be accurately distributed to automobile manufacturers, banks or financial mechanisms, various insurance companies and automobile-related industries, profit sharing is carried out through a commission standard protocol, market integration is realized through innovative modes, automobile purchase data is locked through big data, and clients are distributed to car dealers, the financial companies, the insurance companies and the automobile manufacturers; the big data is utilized to integrate car-related products, client transform is carried out, andsecondary values are realized through secondary consumption and automobile-related products; the method is applicable to sales of complete automobiles, sales of new energy automobiles and widespreadpromotion of the entire automobile-related industry market.

Owner:广东龙源电子商务科技有限公司

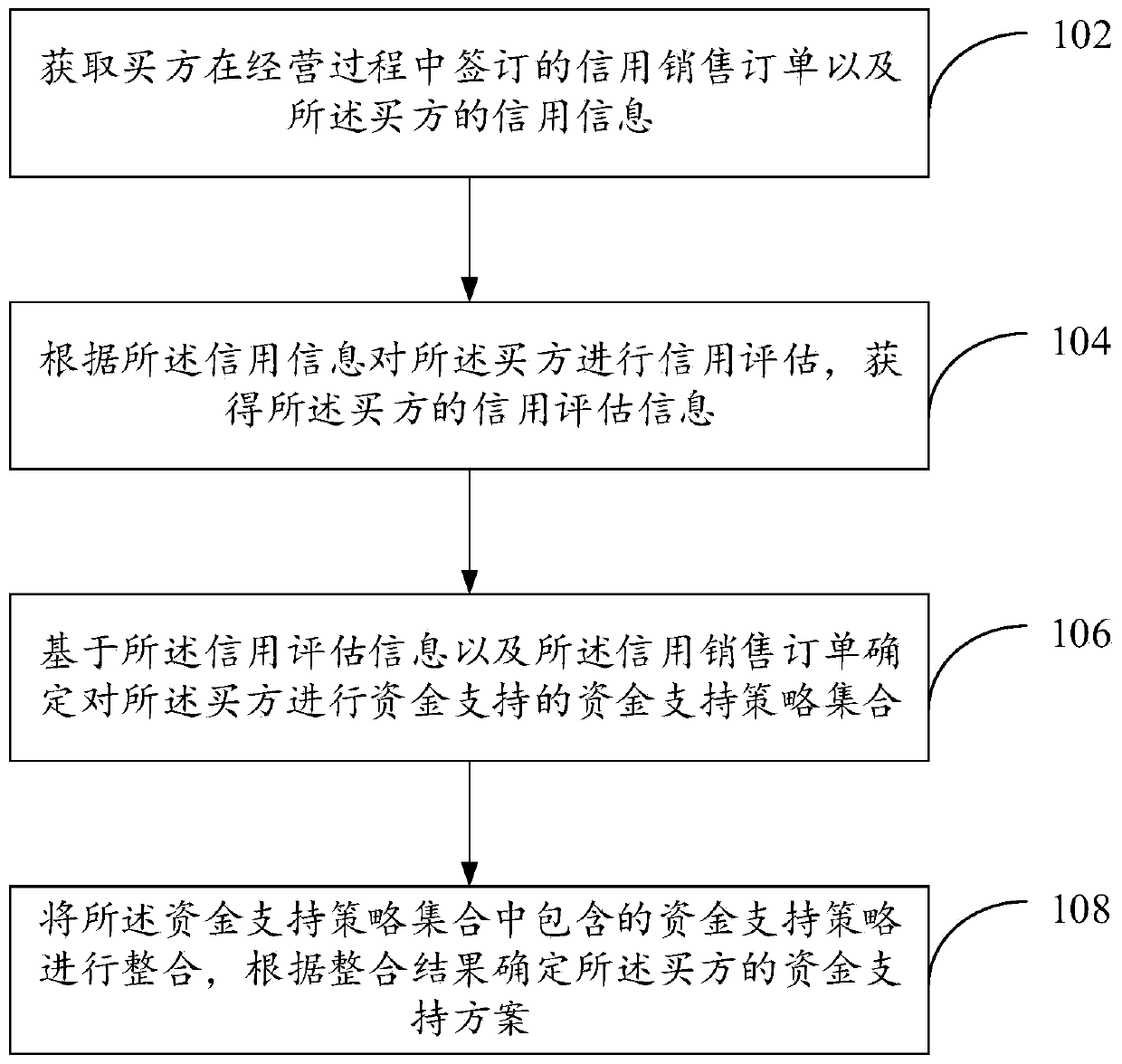

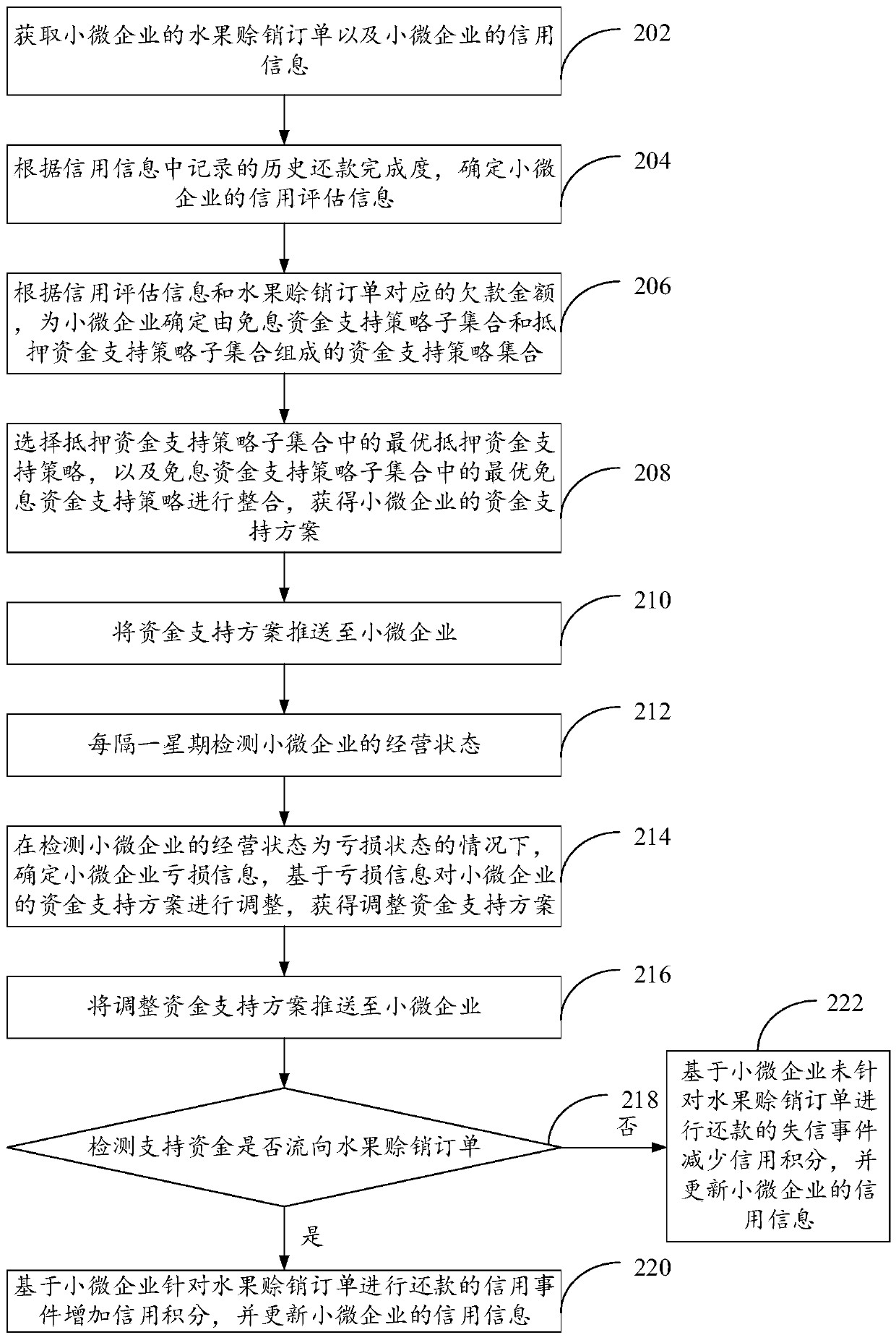

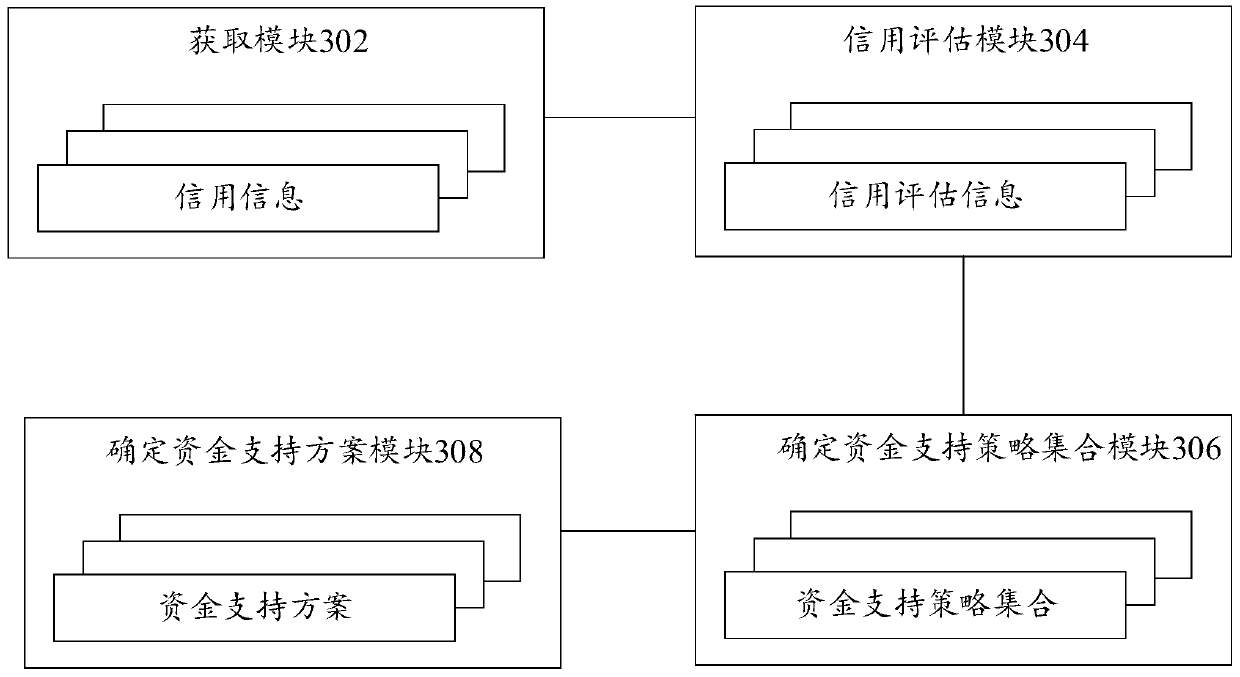

Credit-based fund support scheme determination method and device

Owner:ADVANCED NEW TECH CO LTD

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com