Financial individual loan risk assessment method and device, storage medium and equipment

A technology of risk assessment and risk assessment model, which is applied in the field of financial personal loan risk assessment, can solve the problems of inability to guarantee data copyright user data privacy, inability to multi-party data federated learning, inability to break data islands, etc., to improve approval efficiency and reduce bad debts efficiency and the effect of ensuring user privacy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

no. 1 example

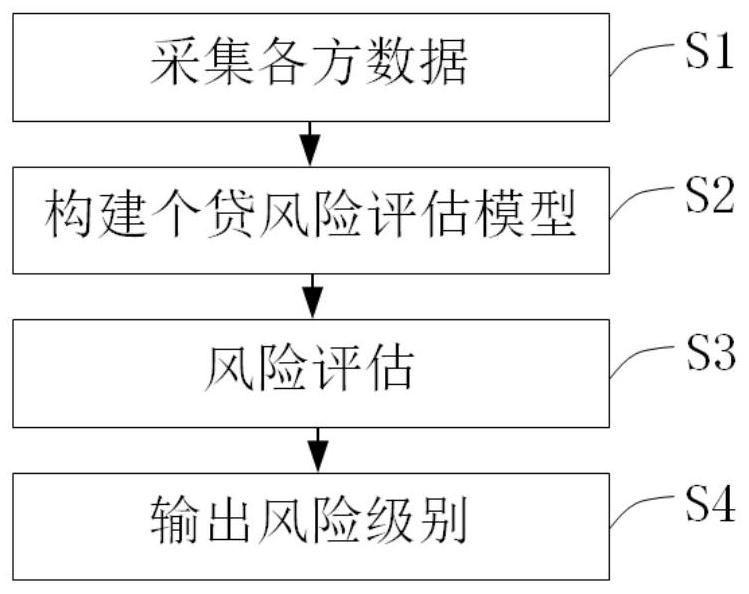

[0044] A risk assessment method for financial personal loans based on federated learning, see figure 1 , methods include:

[0045] S1. Collect data from all parties to participate in risk assessment tasks;

[0046] S2. Building a personal loan risk assessment model: Based on the data of all parties, the federated decision tree is obtained through the SecureBoost federated learning algorithm, and the federated decision tree is trained as a personal loan risk assessment model;

[0047] S3. Risk assessment: the user applies for a personal loan, enters the user information into the personal loan risk assessment model, and performs risk assessment;

[0048] S4. Output the risk level, classify the users through the personal loan risk assessment model, and output the decision report as the risk assessment result as the basis for the loan risk assessment.

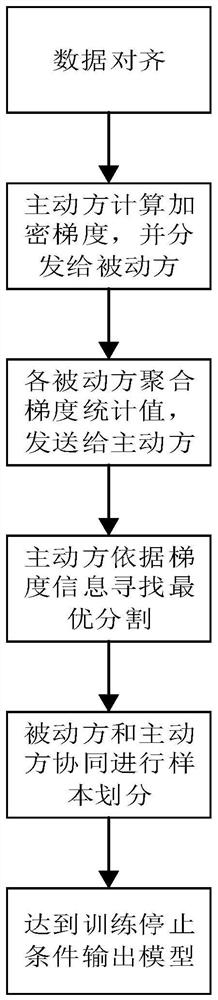

[0049] Among them, the construction method of the personal loan risk assessment model in step S2. SecureBoost is an improved lon...

no. 2 example

[0081] A risk assessment device for financial personal loans based on federated learning, the device includes:

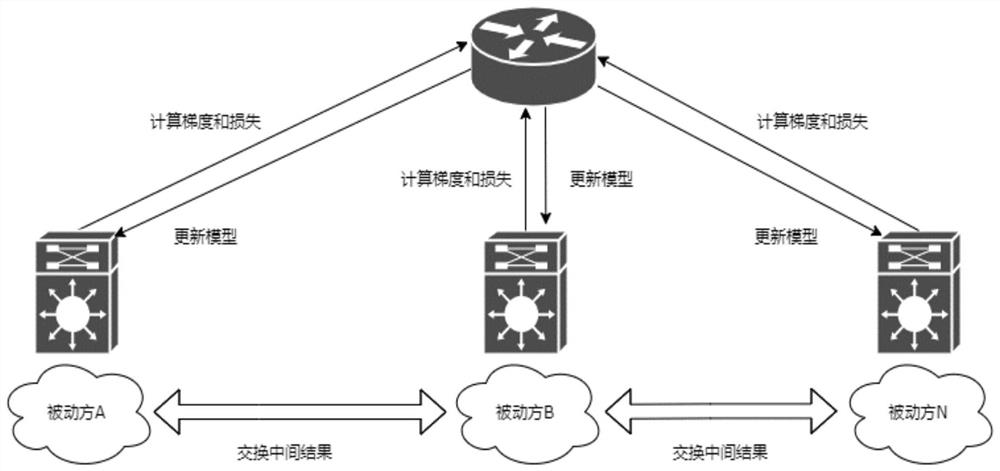

[0082] The data processing module is used to obtain common samples owned by each passive party, align data based on the SecureBoost algorithm, and perform homomorphic encryption on the data;

[0083] The risk assessment module builds a decision tree based on common samples as a personal loan risk assessment model, and when receiving a user request for a financial personal loan, enters the user data for iterative calculation, and obtains the classification label as the risk assessment result;

[0084] The output module is used to obtain the risk assessment results of the risk assessment module and the manual assessment conclusions of the assessment experts, and generate corresponding lending decision suggestions based on the risk assessment results and / or the assessment conclusions of the assessment experts.

[0085] Using the risk assessment principle of the device,...

no. 3 example

[0087] A computer-readable storage medium, on which a financial personal loan risk assessment instruction is stored, wherein when the financial personal loan risk assessment instruction is executed by a processor, the financial personal loan risk assessment method of the first embodiment is executed A step of. Among them, for the evaluation method, please refer to the detailed introduction in the previous section, and will not repeat it here.

[0088]Those of ordinary skill in the art can understand that all or part of the steps in the various methods of the above-mentioned embodiments can be completed by instructing related hardware through a program, and the program can be stored in a computer-readable storage medium, and the computer-readable medium includes permanent Both non-permanent and non-permanent, removable and non-removable media can be implemented by any method or technology for information storage. Information may be computer readable instructions, data structur...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com