Business data review method, device, equipment, and computer-readable storage medium

A data and data group technology, applied in the field of financial credit, can solve the problems of bad loans and capital losses, inaccurate evaluation results, and excessive time.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0055] It should be understood that the specific embodiments described here are only used to explain the present invention, not to limit the present invention.

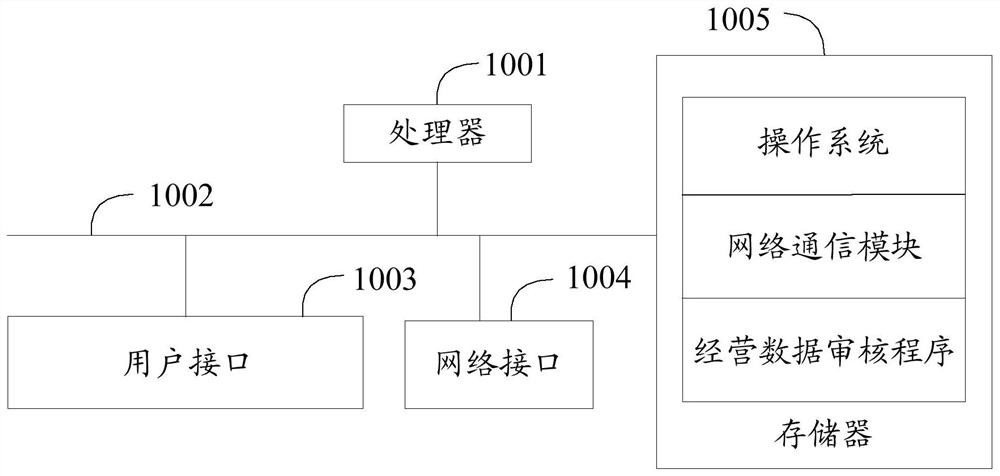

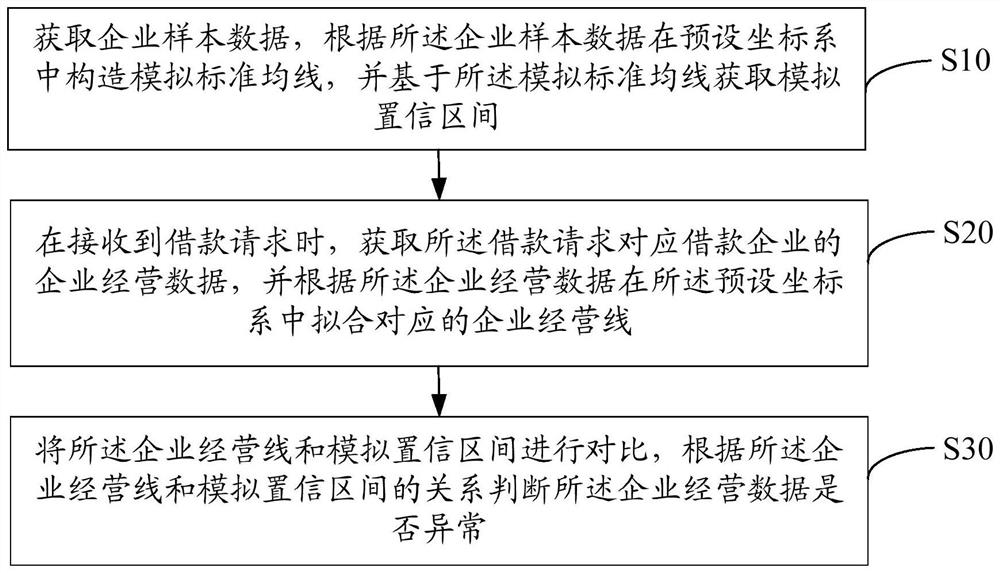

[0056] The main idea of the embodiment scheme of the present invention is: obtain enterprise sample data, construct a simulated standard average in the preset coordinate system according to the enterprise sample data, and obtain a simulated confidence interval based on the simulated standard average; when receiving a loan request , obtaining the business operation data of the borrowing company corresponding to the loan request, and fitting the corresponding business operation line in the preset coordinate system according to the business operation data; comparing the business operation line with the simulated confidence interval, It is judged whether the business operation data is abnormal according to the relationship between the business operation line and the simulation confidence interval.

[0057] The business ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com