Credit evaluation method and device, storage medium and computer device

A technology of credit evaluation and credit scoring, which is applied in computing, data processing applications, instruments, etc., can solve the problems of financial enterprise losses, lack of investigation of gang fraud, etc., and achieve the effect of reducing bad debt rate and improving loan security

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0027] Hereinafter, the present application will be described in detail with reference to the drawings and embodiments. It should be noted that, in the case of no conflict, the embodiments in the present application and the features in the embodiments can be combined with each other.

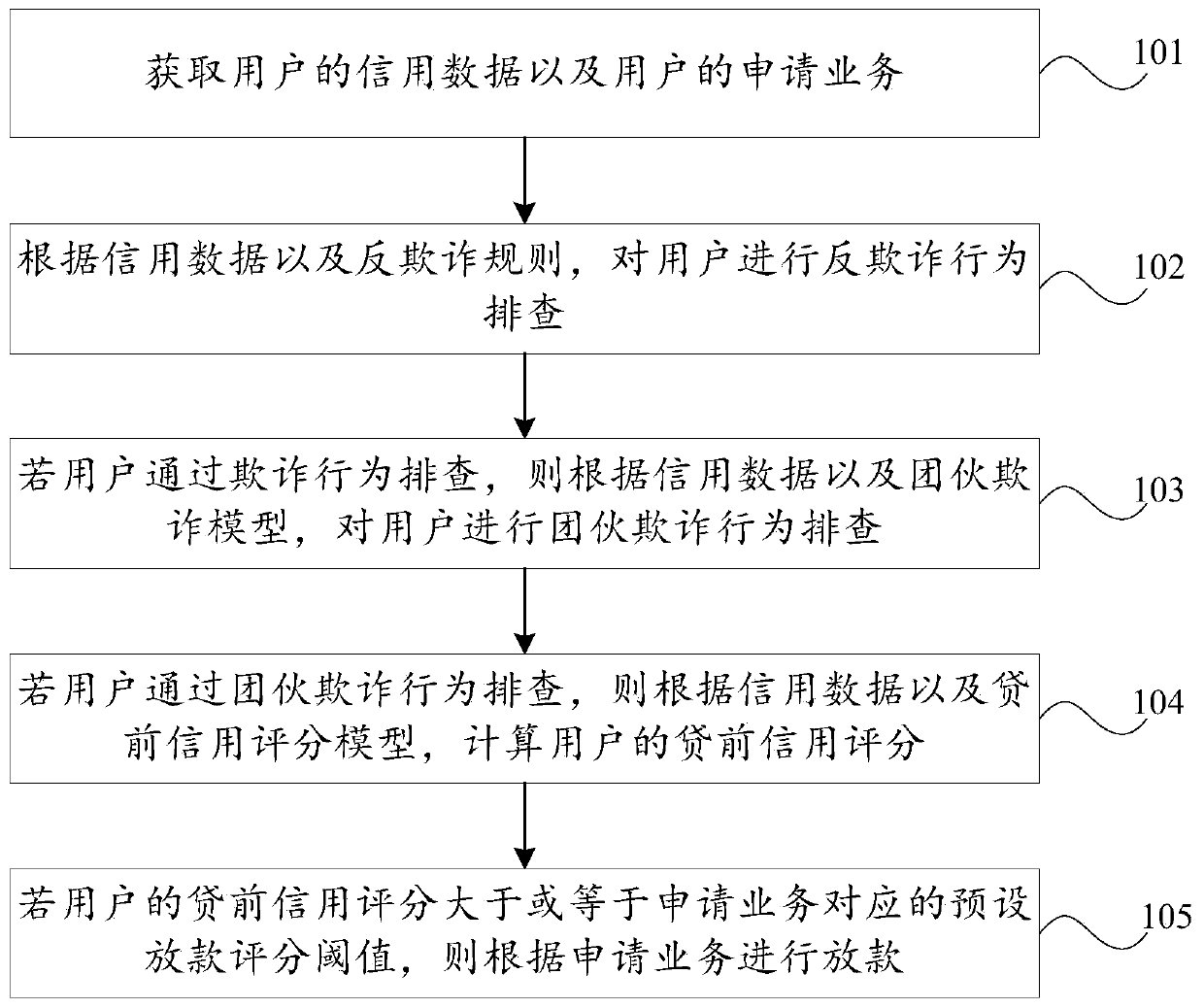

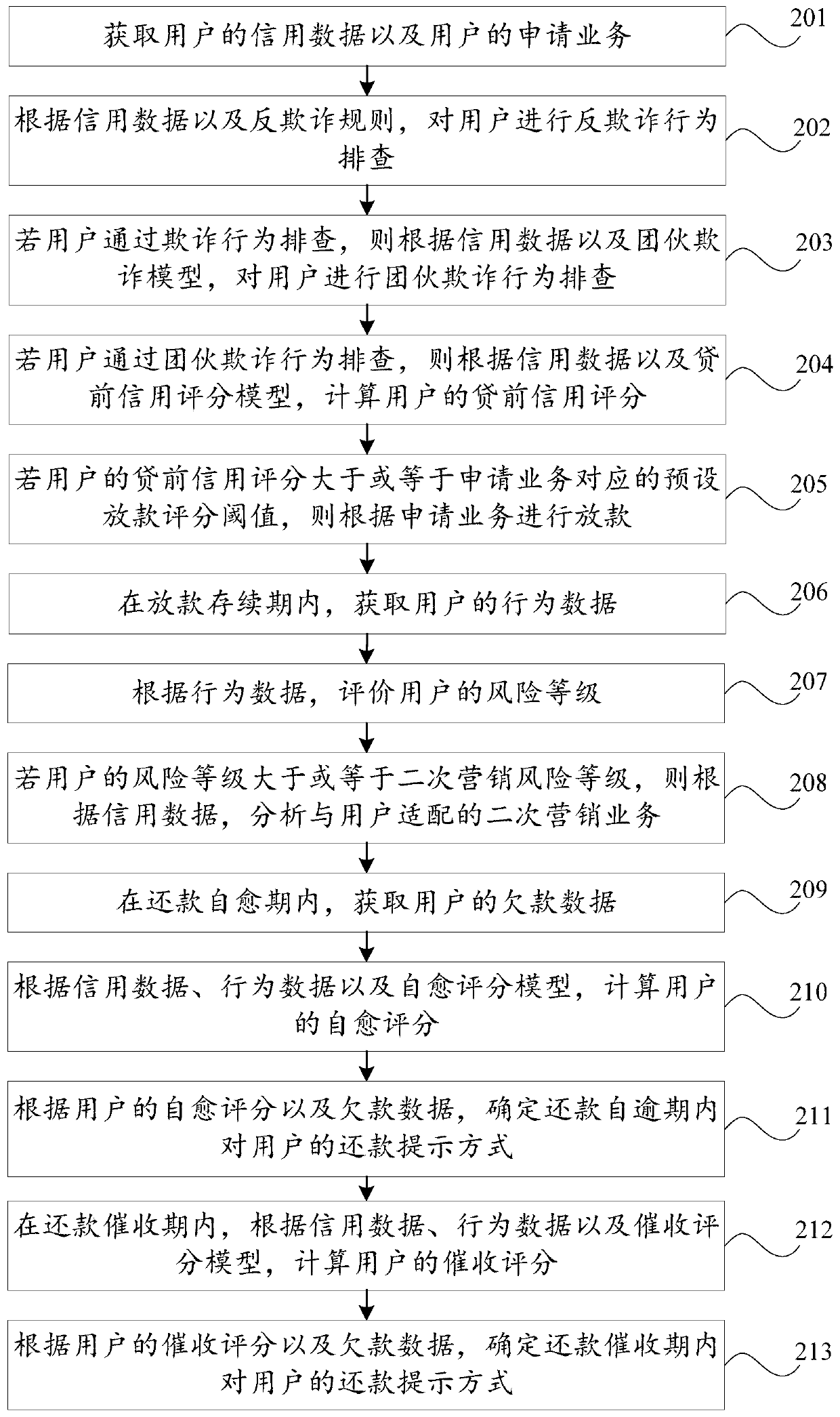

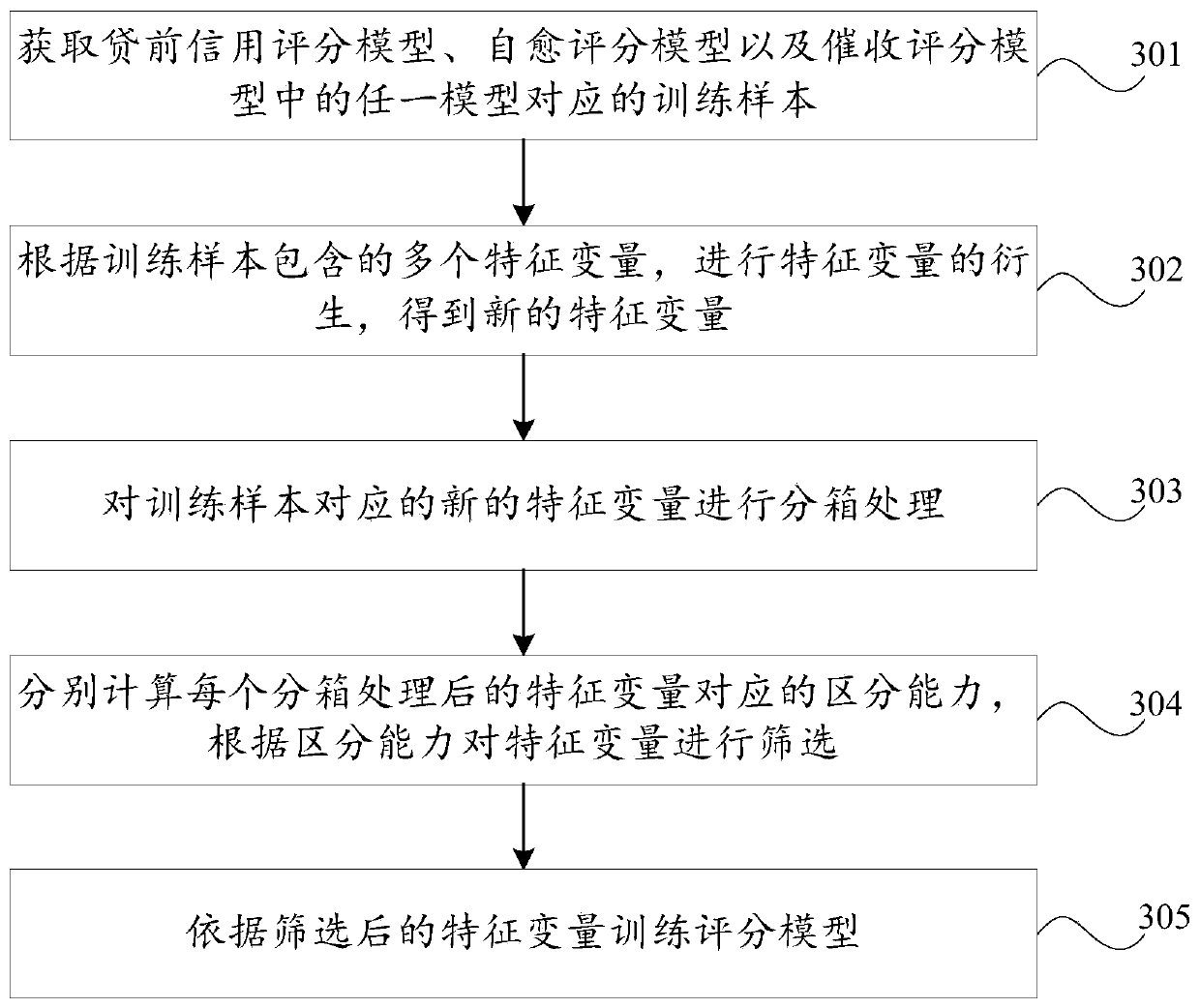

[0028] In this embodiment, a credit evaluation method is provided, such as figure 1 As shown, the method includes:

[0029] Step 101, acquire the user's credit data and the user's application business.

[0030] When a user has a business application requirement, obtain the user's credit data and the user's application business. The user's credit data can include the user's identity information, income certificate, asset certificate, consumption information, credit information, etc., and the application business can include the user's Submitted loan amount.

[0031] Step 102, according to the credit data and anti-fraud rules, check the anti-fraud behavior of the user.

[0032] Use the obtaine...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com