Personal-credit evaluation method of intelligent combination and system

A credit evaluation and credit scoring technology, applied in the field of data processing, can solve the problems of inability to obtain strong financial attribute data, low model accuracy, etc., and achieve accurate training and more interpretability, enhanced risk control ability, and improved prediction accuracy. Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

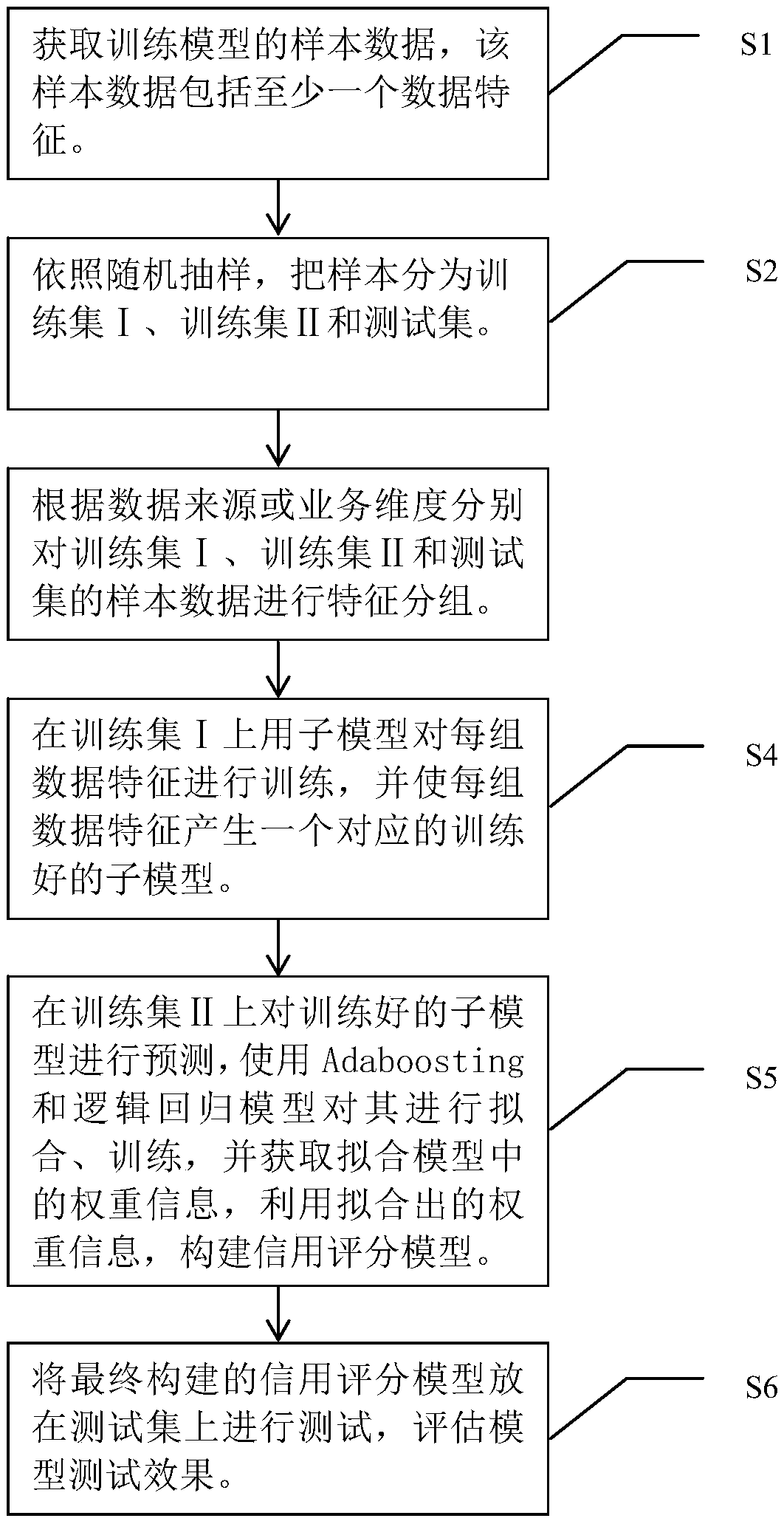

[0032] Below in conjunction with accompanying drawing, specific embodiment of the present invention is described in further detail:

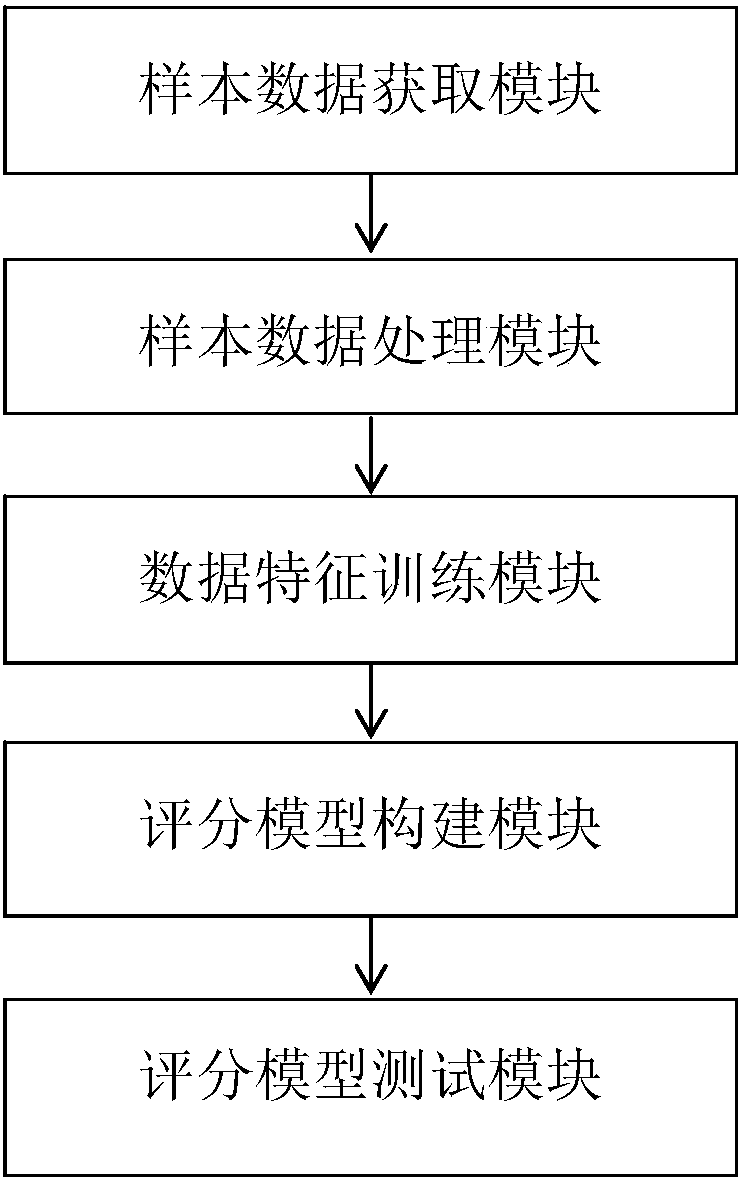

[0033] as attached figure 1 , 2 As shown, an intelligent combined personal credit evaluation method is applicable to a personal credit evaluation system, and the system includes a sample data acquisition module, a sample data processing module, a data feature training module, a scoring model building module and a scoring model Test module, the personal credit evaluation method of described intelligent combination comprises the following steps:

[0034] S1 acquires sample data of the training model by the sample data acquisition module, the sample data includes at least one data feature;

[0035] S2 divides the samples into training set I, training set II and test set according to random sampling by the sample data processing module;

[0036] S3 performing feature grouping on the sample data of the training set I, the training set II, and the ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com