Adaptive stock prediction method of hidden Markov model based on multi-characteristic factor

A prediction method, multi-feature technology, used in data processing applications, character and pattern recognition, instrumentation, etc.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0044] The present invention will be further described below in conjunction with the accompanying drawings and specific embodiments.

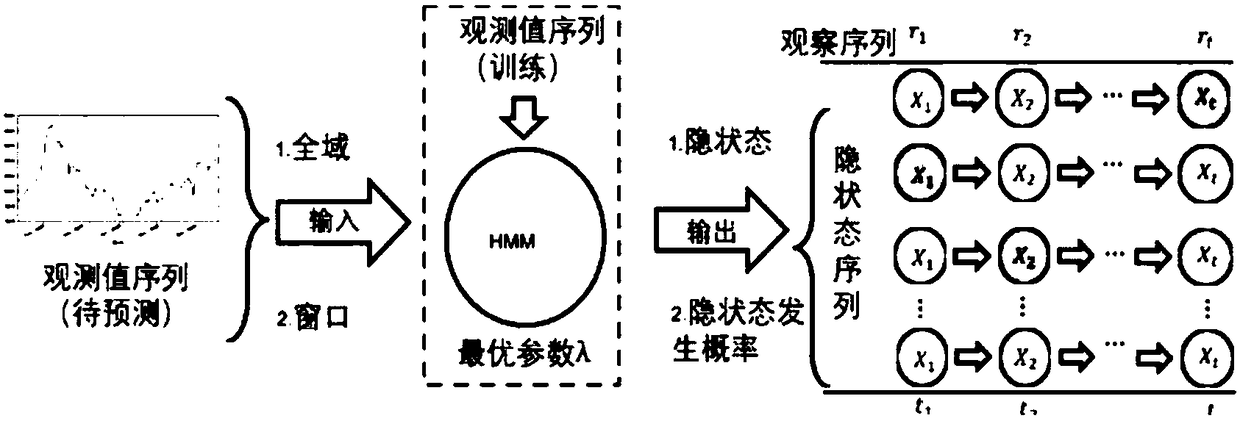

[0045] The present invention mainly consists of stock data and HMM. The stock data is the trading day data of the Shanghai and Shenzhen Index from 2007.1.4-2017.4.10. The algorithm is an HMM that assumes first-order Markov and the independence of the state and observation values at the current time point.

[0046] S1 data preparation:

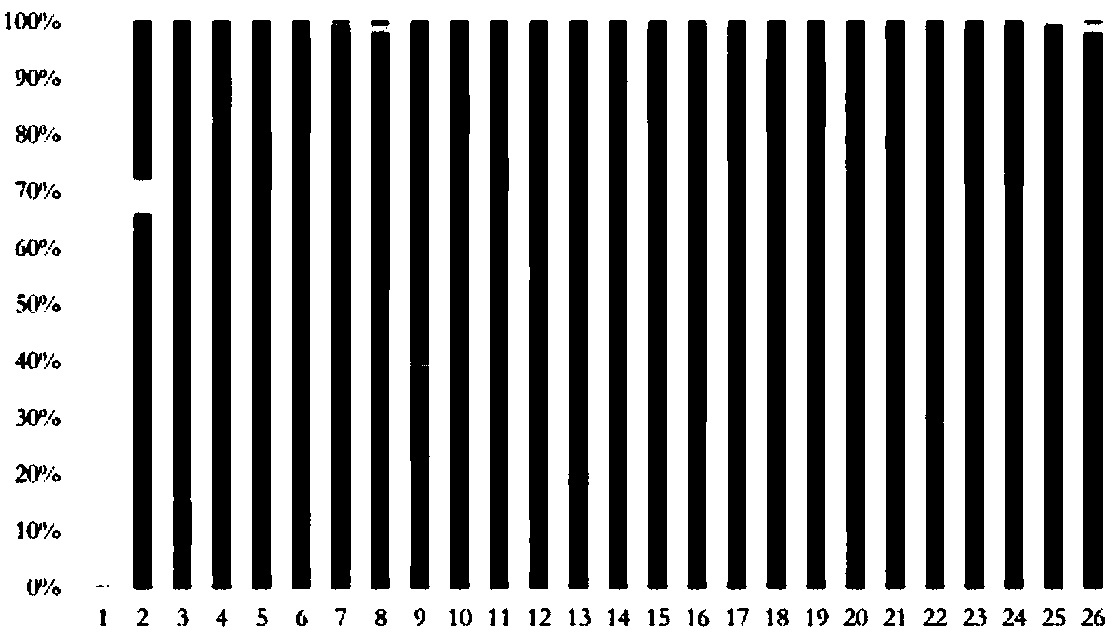

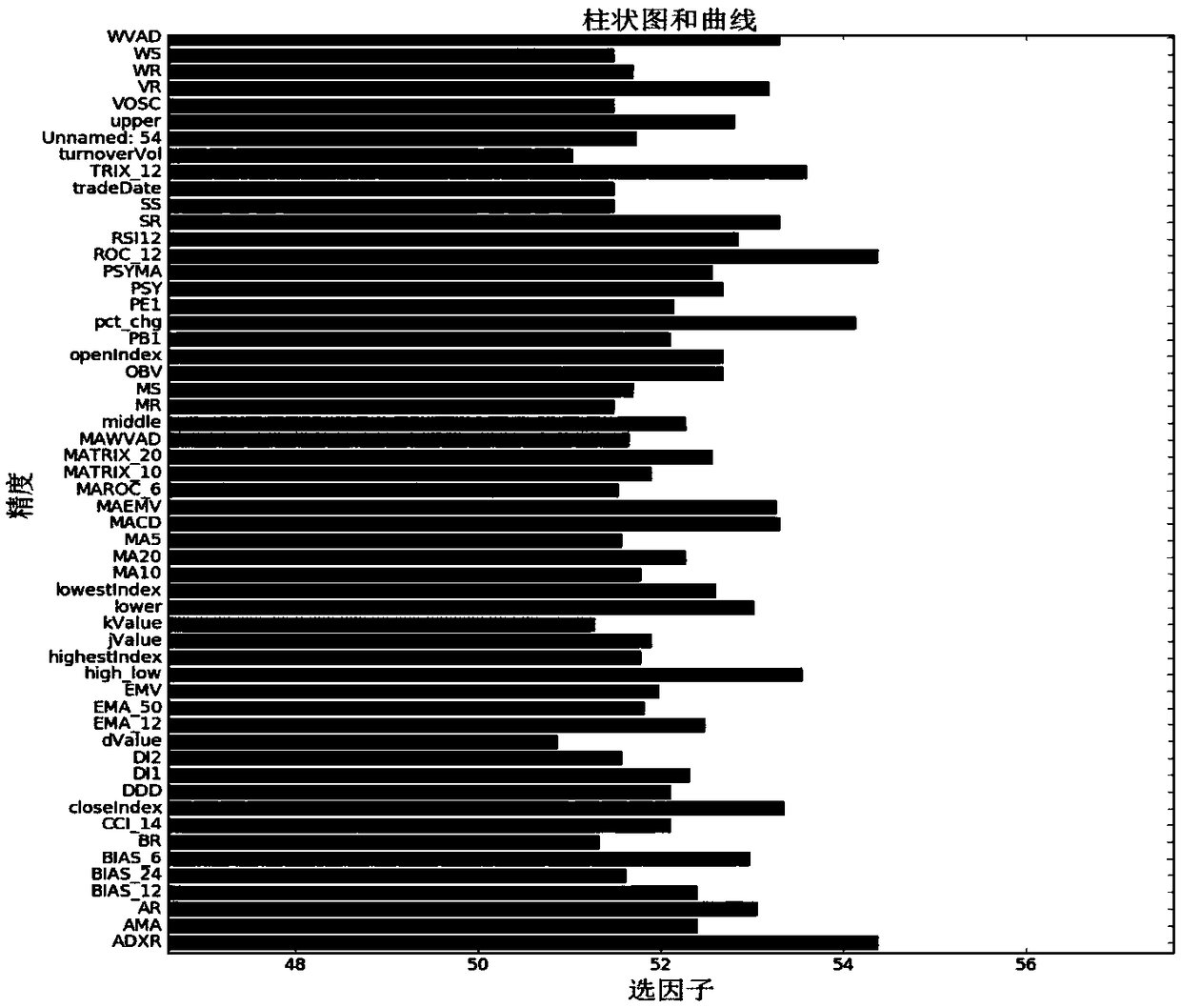

[0047] Step 1: Collect data through Caijing.com, Scapy, and indicator calculation formulas, such as Image 6 shown.

[0048] Step 2: Perform preprocessing such as normalization and regularization on the collected data.

[0049] Step 3: Divide the preprocessed collected stock data into a training data set and a testing data set.

[0050] S2 build model parameters:

[0051] Step 1: Use python's hmmlearn.hmm to learn the internal parameters of the hmm algorithm, which is the core algorithm of this model, usi...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com