Patents

Literature

57 results about "Stock investment" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Stocks are an equity investment that represents part ownership in a corporation and entitles you to part of that corporation's earnings and assets. Common stock gives shareholders voting rights but no guarantee of dividend payments.

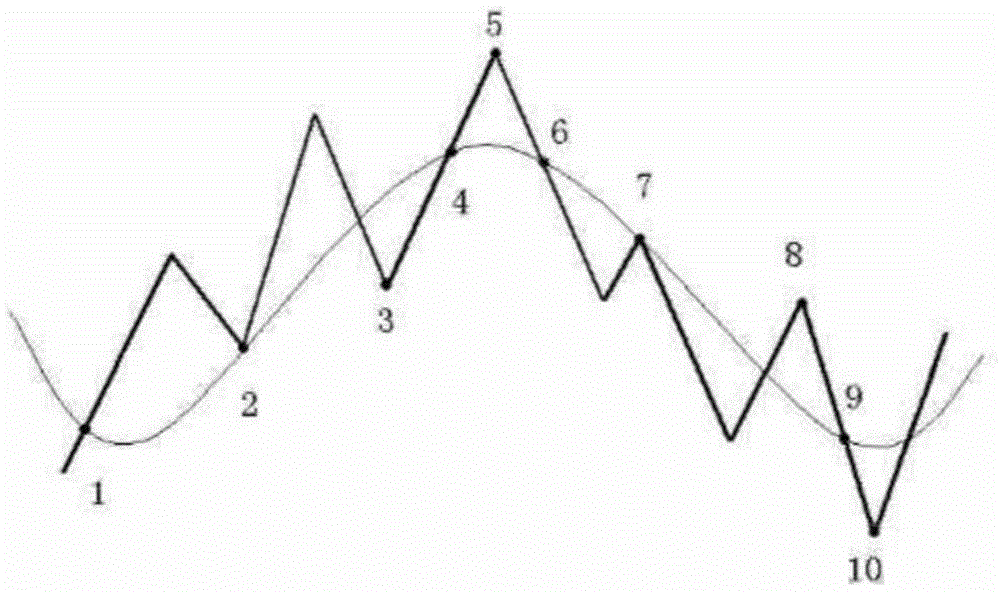

Computerized method, process and service for stock investment timing

InactiveUS20020099636A1Filtered outEasy to calculateFinanceBuying/selling/leasing transactionsThe InternetData mining

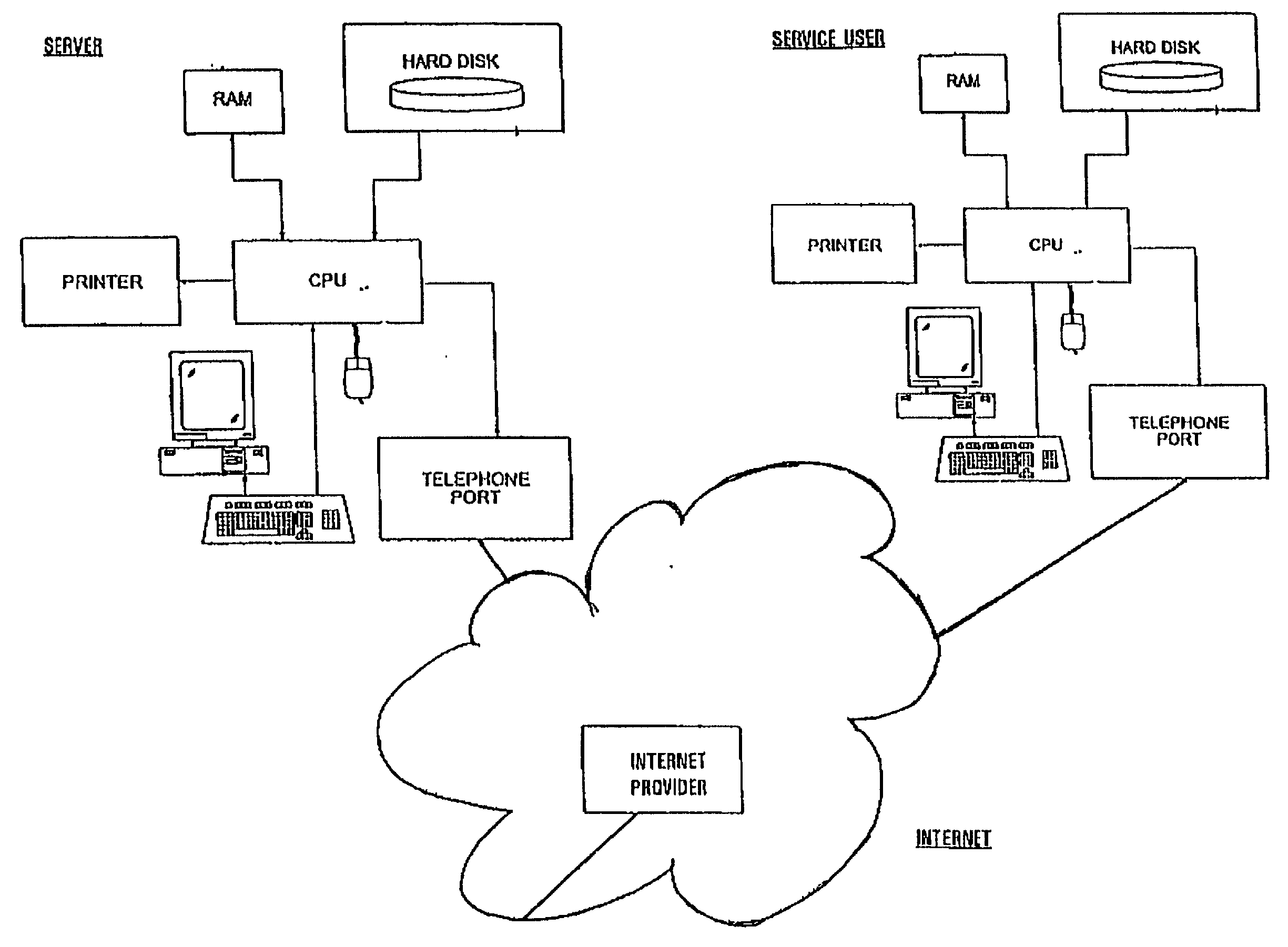

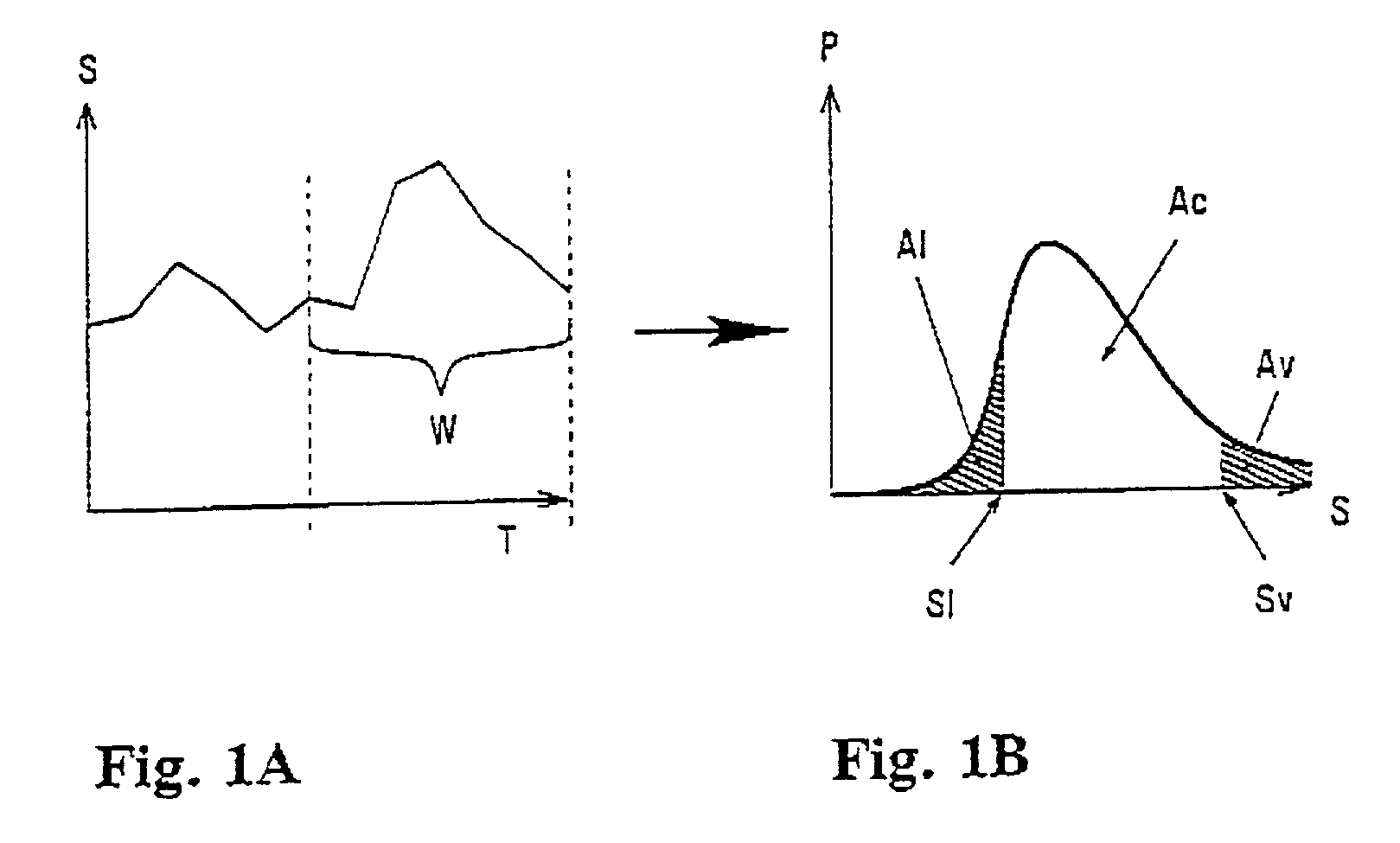

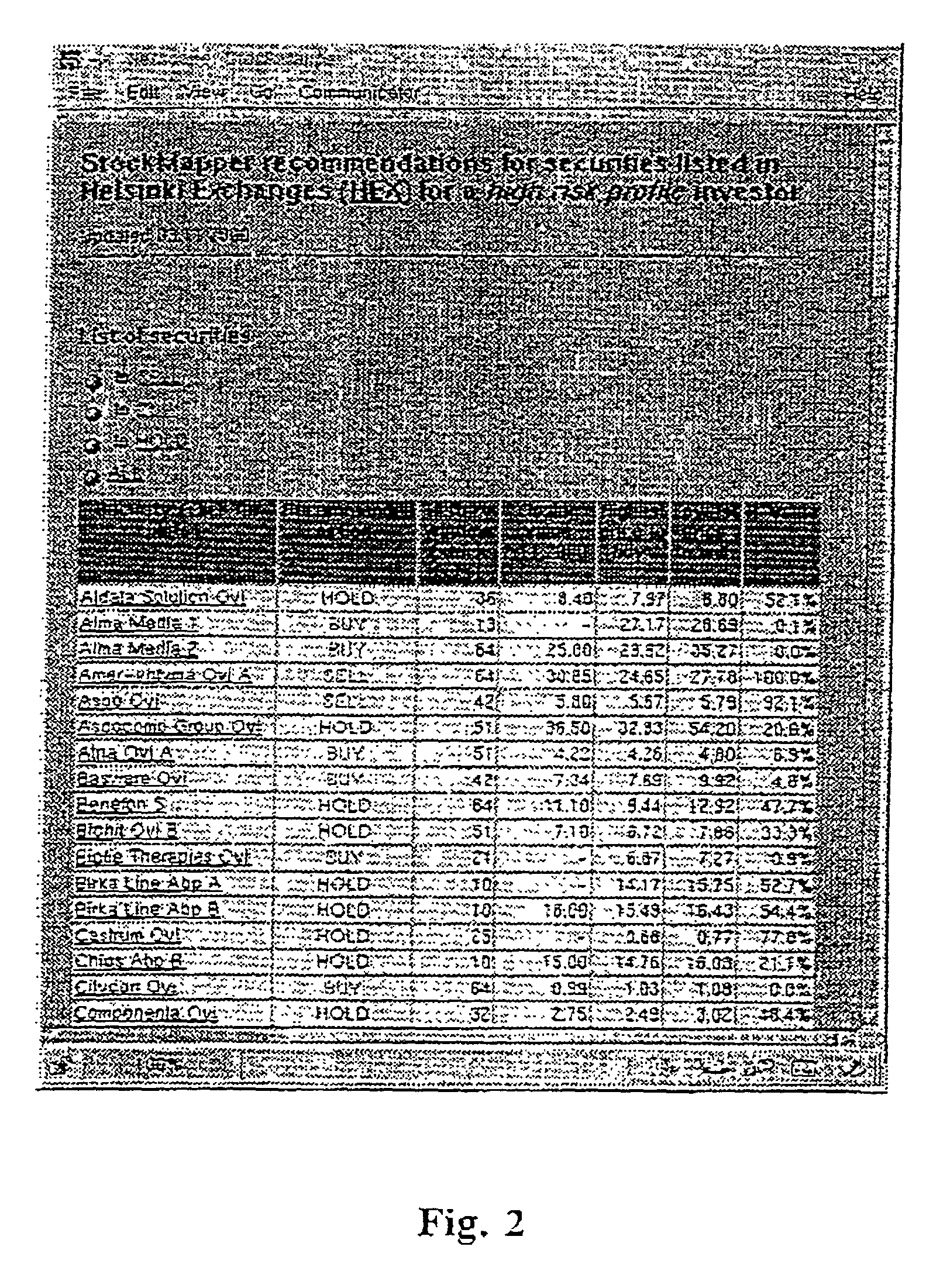

The invention is in the field of using a computer implemented method to calculate and provide recommendations for stock share investment timing. The process gathers price and volume data of listed firms from as many stock markets as implemented, only condition being that those markets price data are available over the Internet, in order to be able to automate the process. Analysing and calculation methods used within the process differ from those used in typical technical stock analyses in that the invention takes advantage of the known price history and uses statistical mathematics to categorize the current price to a recommended action: "sell', "buy' or "hold', while the most famous technical analysing methods typically try to predict the share price in the near future. The clear benefits of the process are that, after being set up properly, the process does not need human intervention, except in rare special cases, and furthermore, the calculated results are very easy to interpret even by persons without much experience in stock investing. Performance statistics clearly show that remarkable increase in profit of stock share investments can be gained by using the recommendations. The method has been implemented in a form of WWW-service and it is usable globally via the Internet. The method has been donated as StockMapper.

Owner:STOCKMAPPER

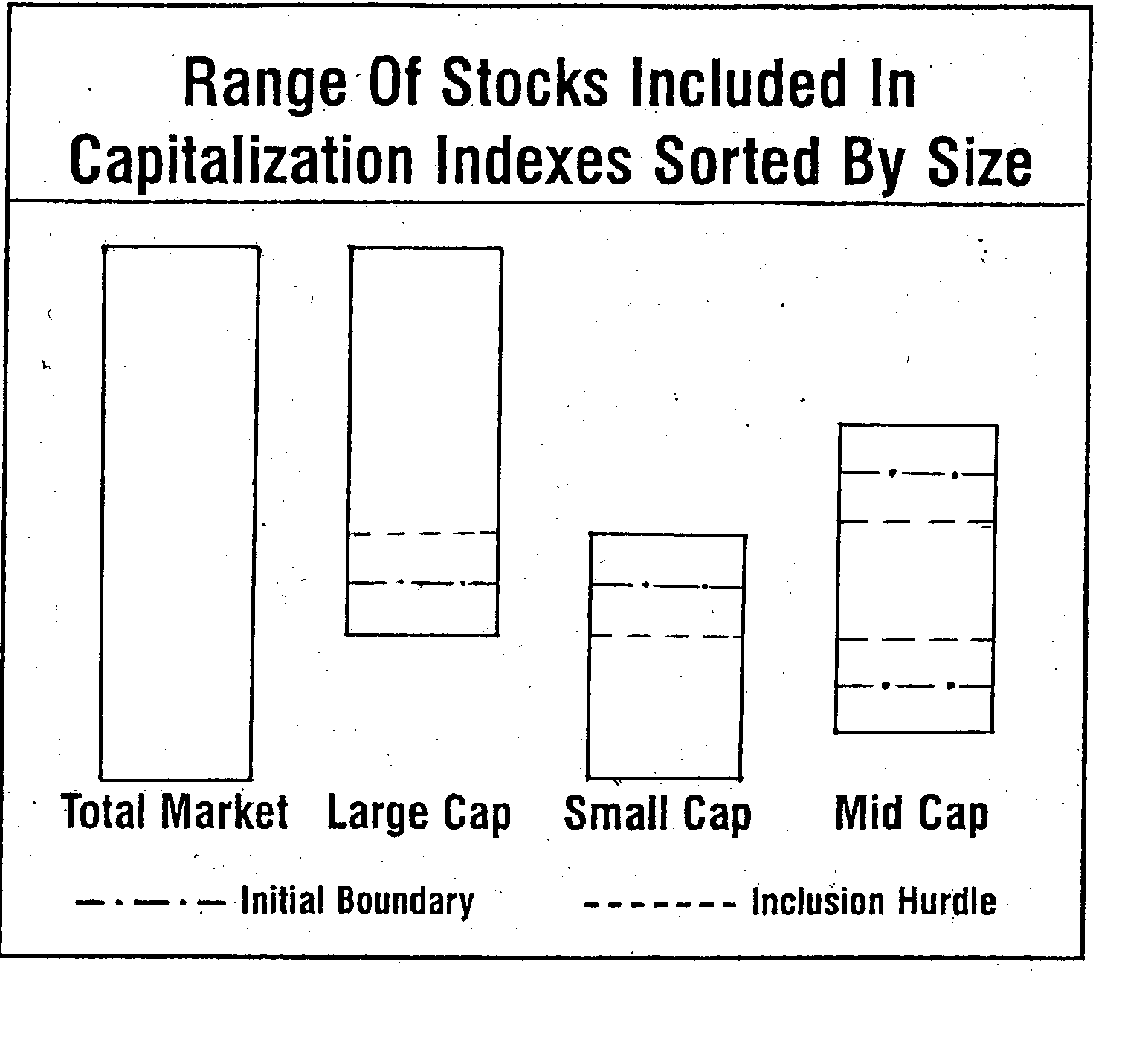

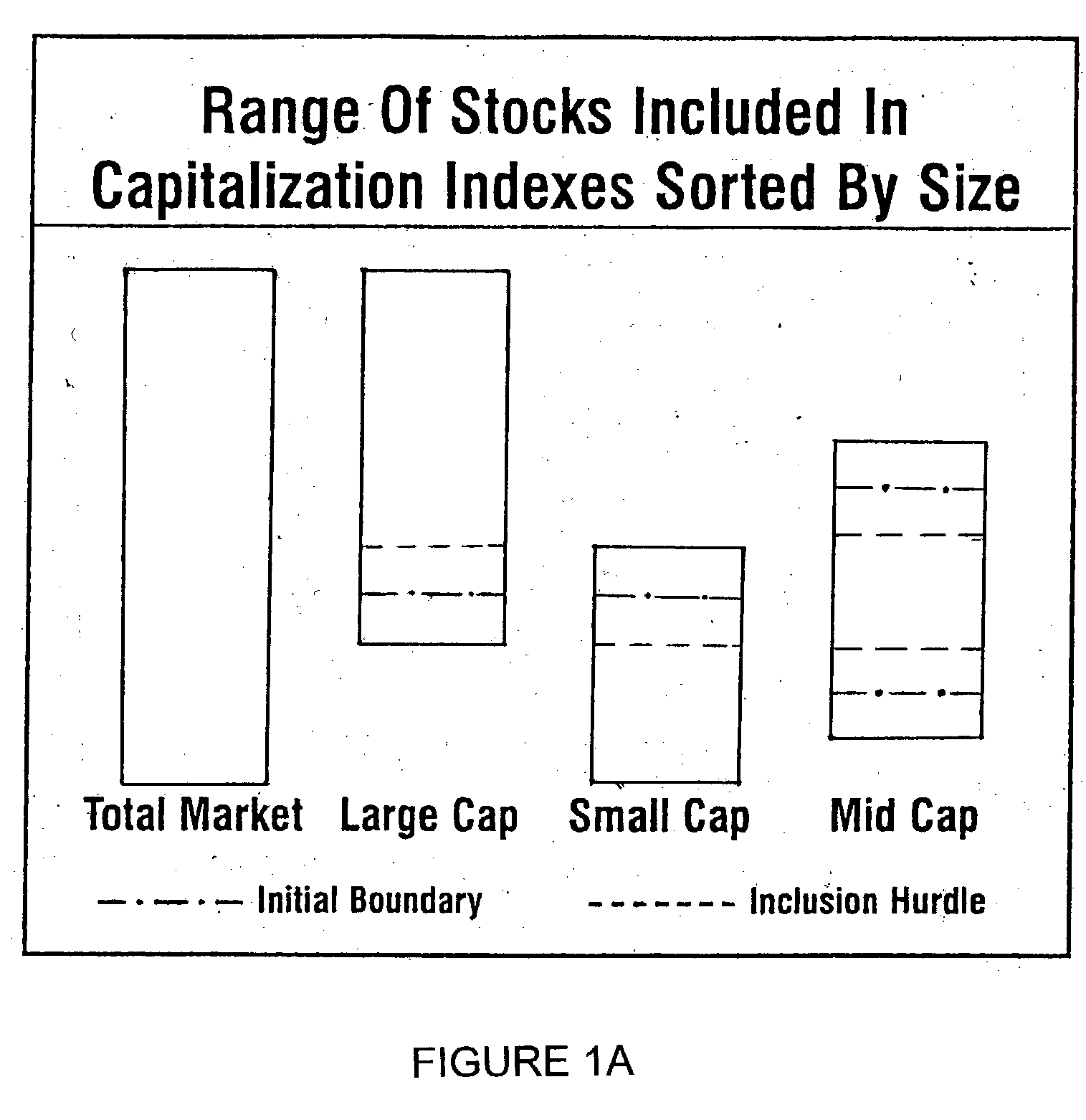

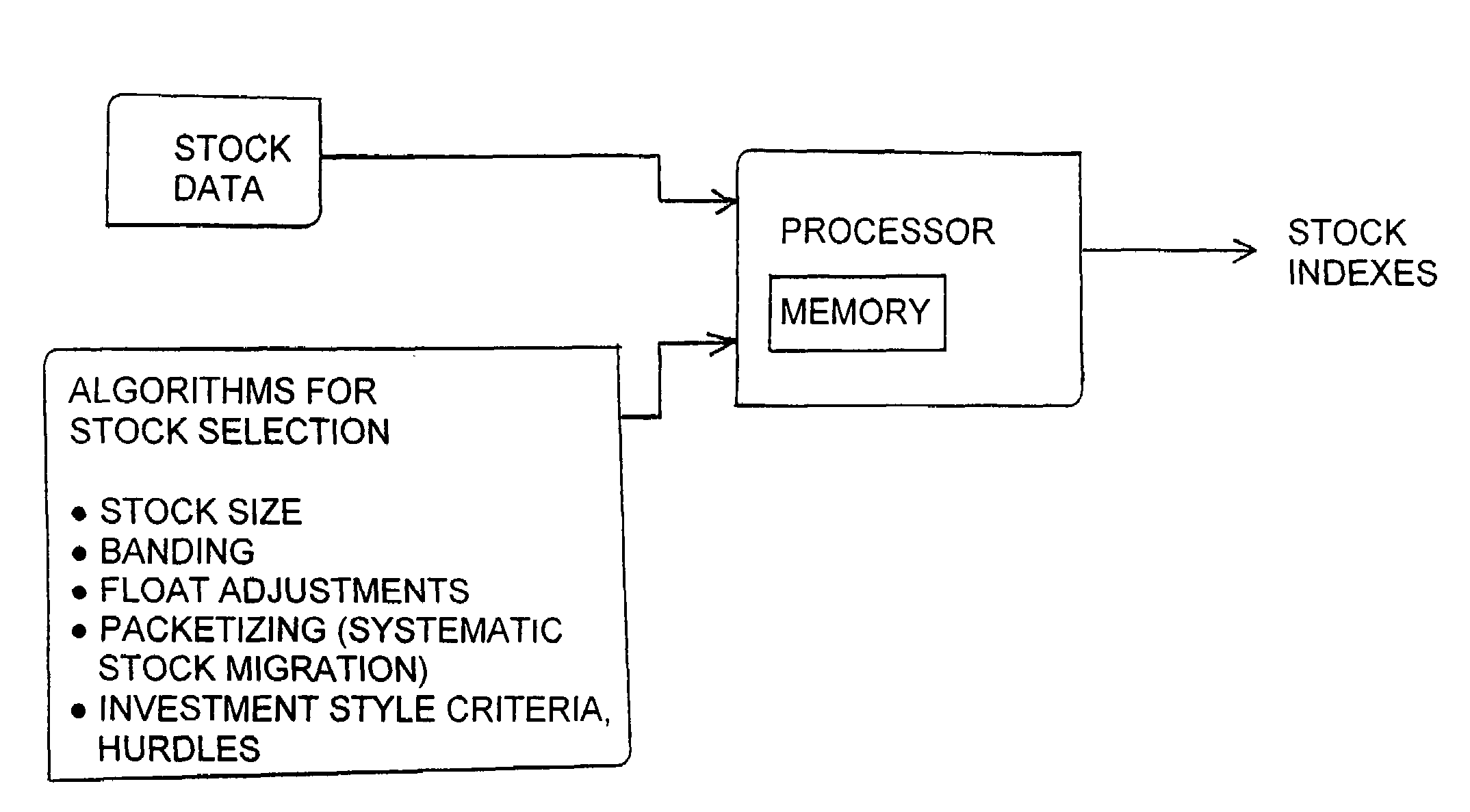

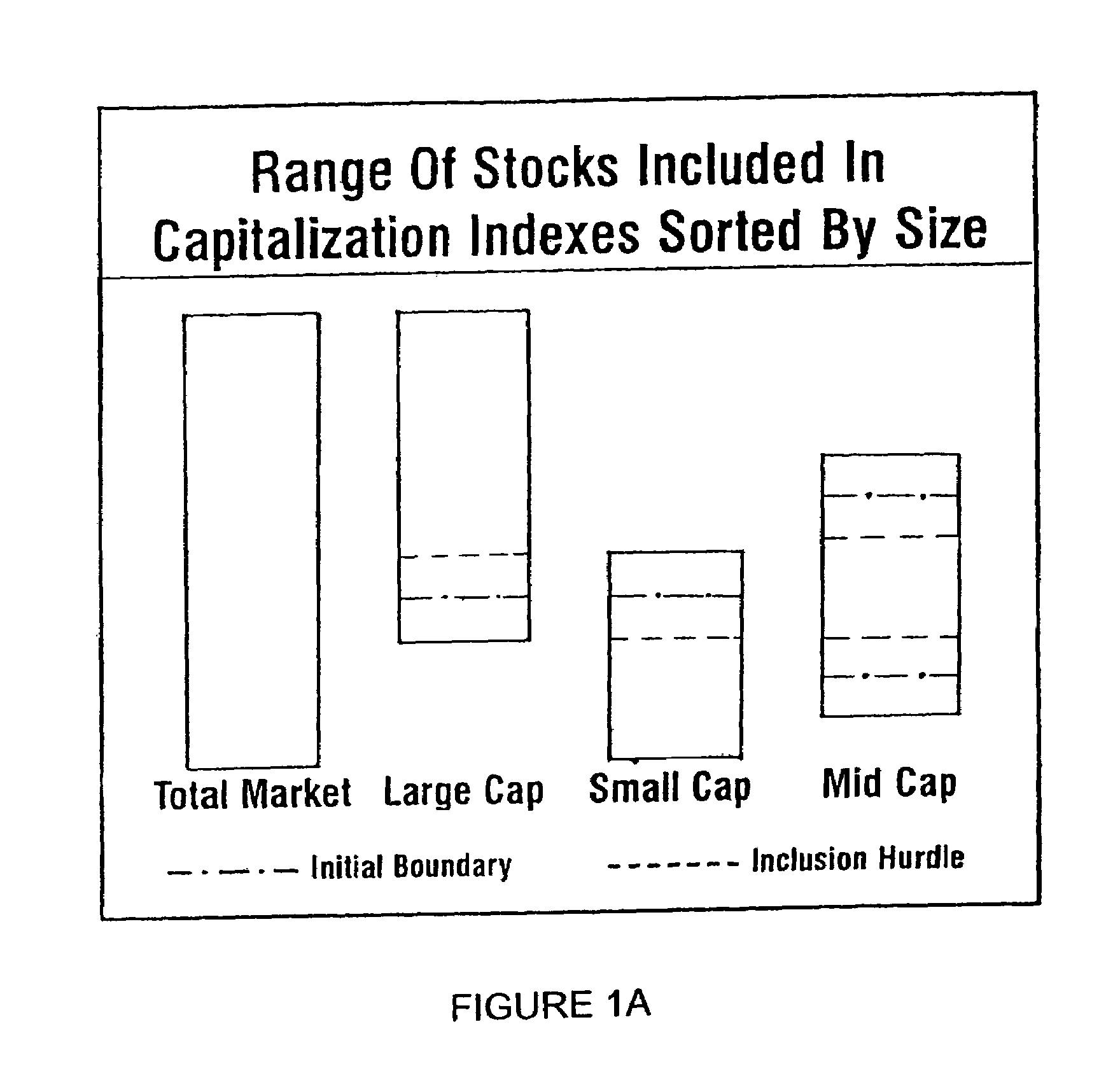

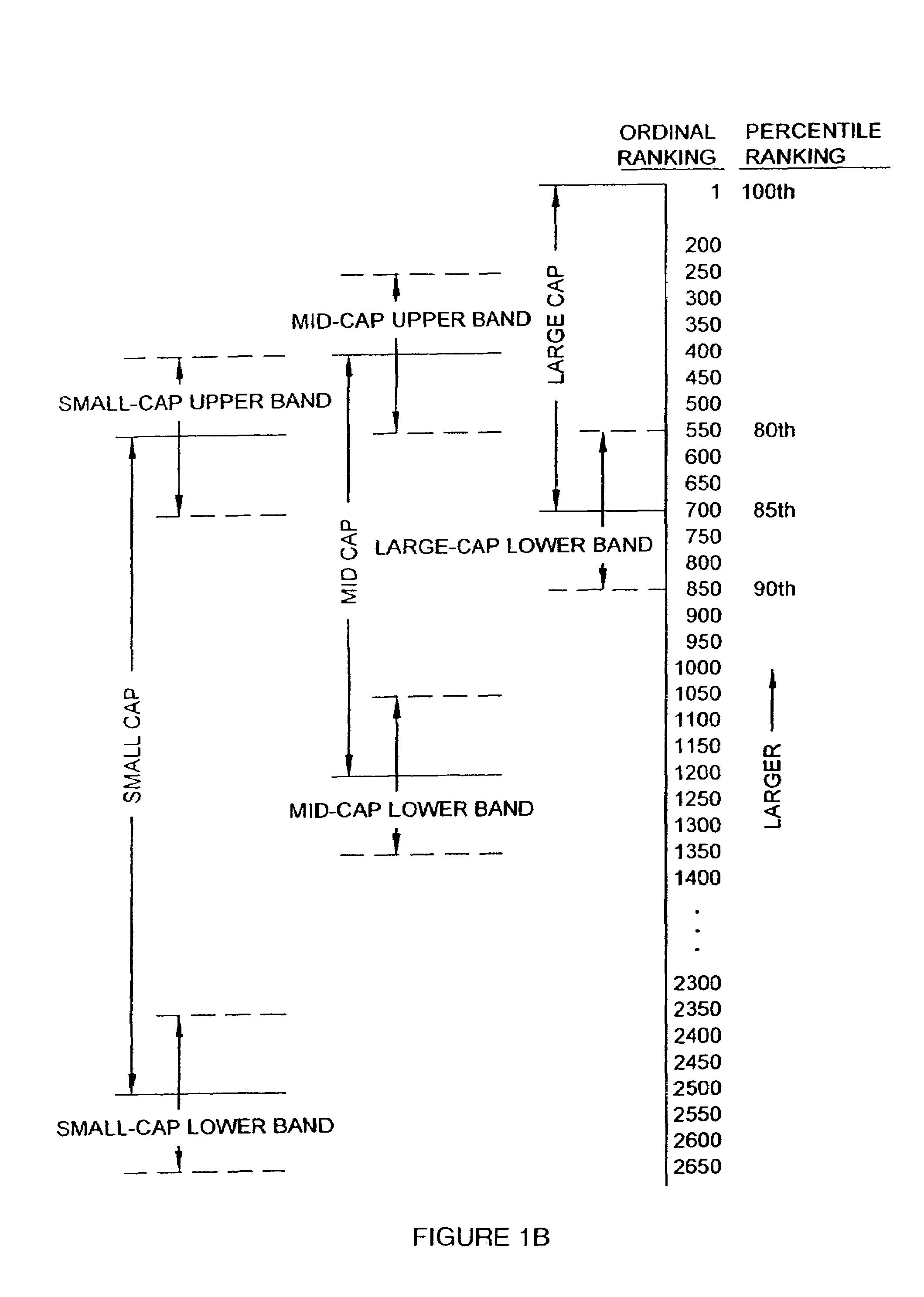

Method of constructing a stock index

Computer-implemented methods of creating and maintaining stock indexes are provided. For a stock index of a particular size, a band is defined around the upper and / or lower limits of the stock index. To be added to, or dropped from, a particular stock index, the stocks must fall outside of the bands for that particular stock index size. Stock migration is controlled using a systematic stock migration process so that stocks are gradually added and deleted from an index. Stock investment style is determined in a multi-dimensional process, instead of a linear process. Furthermore, the number of stocks in the stock index need not be a fixed value, but may depend upon how many stocks meet predefined criteria at any given point in time.

Owner:SIEMENS AG +1

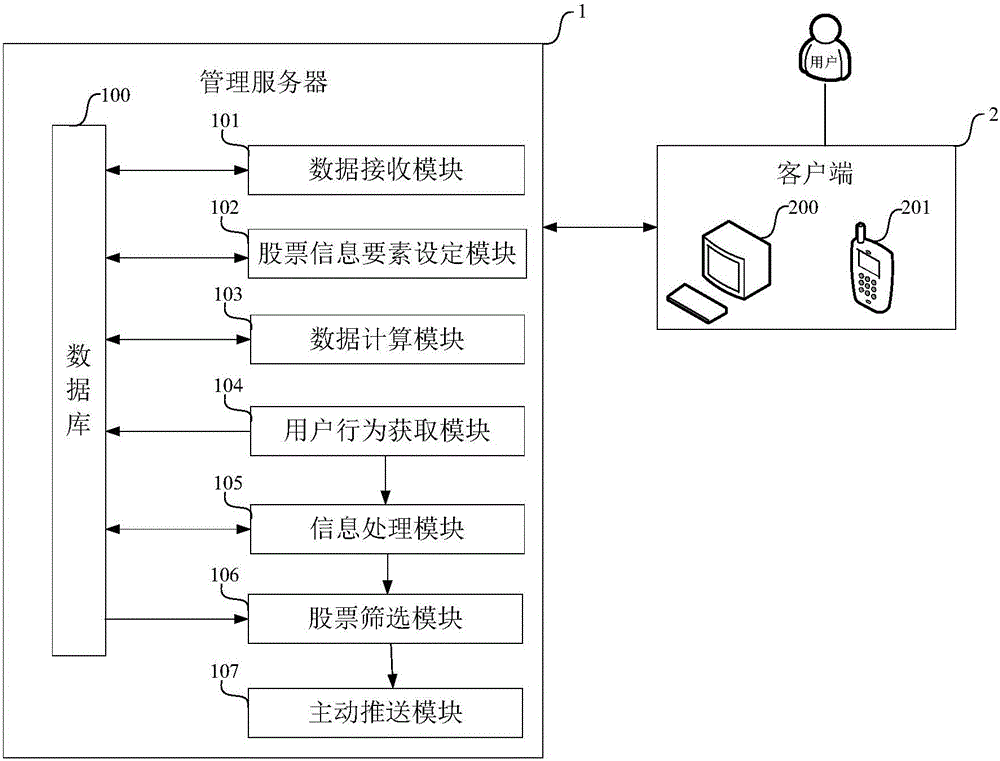

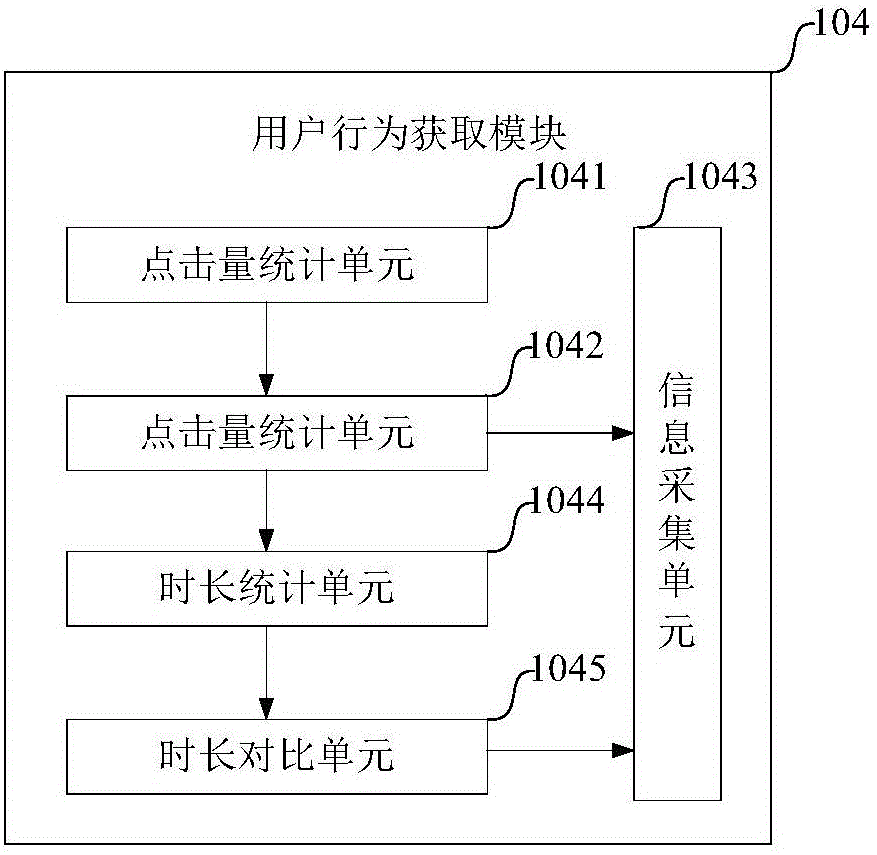

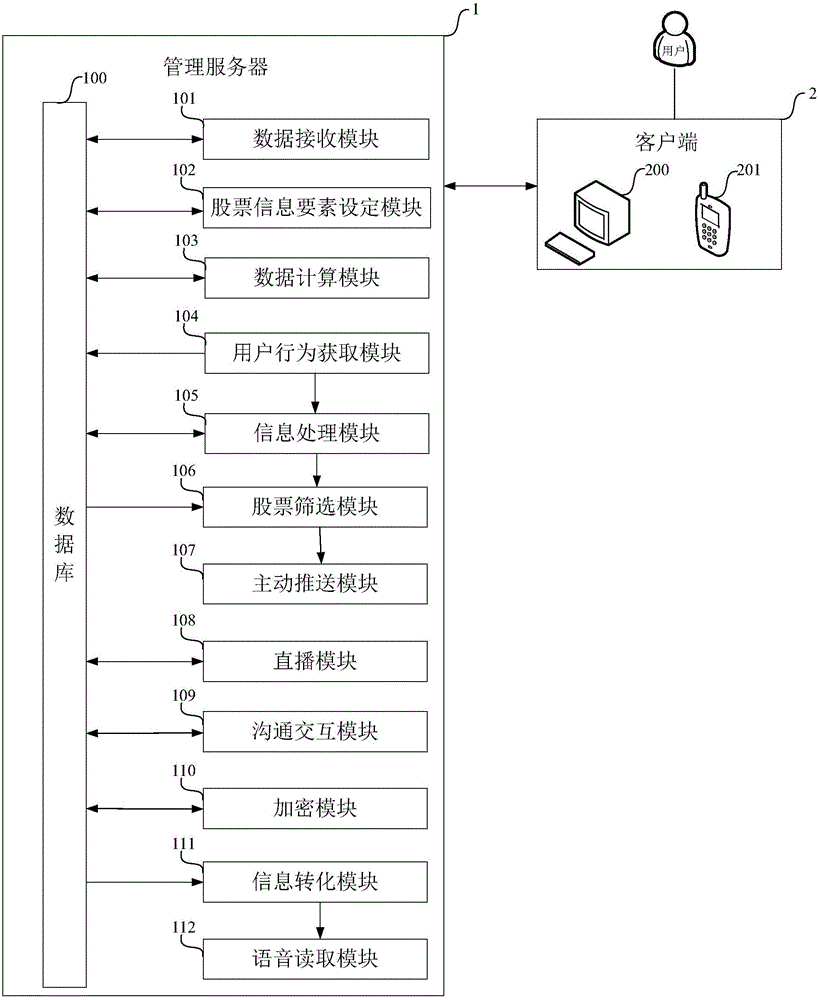

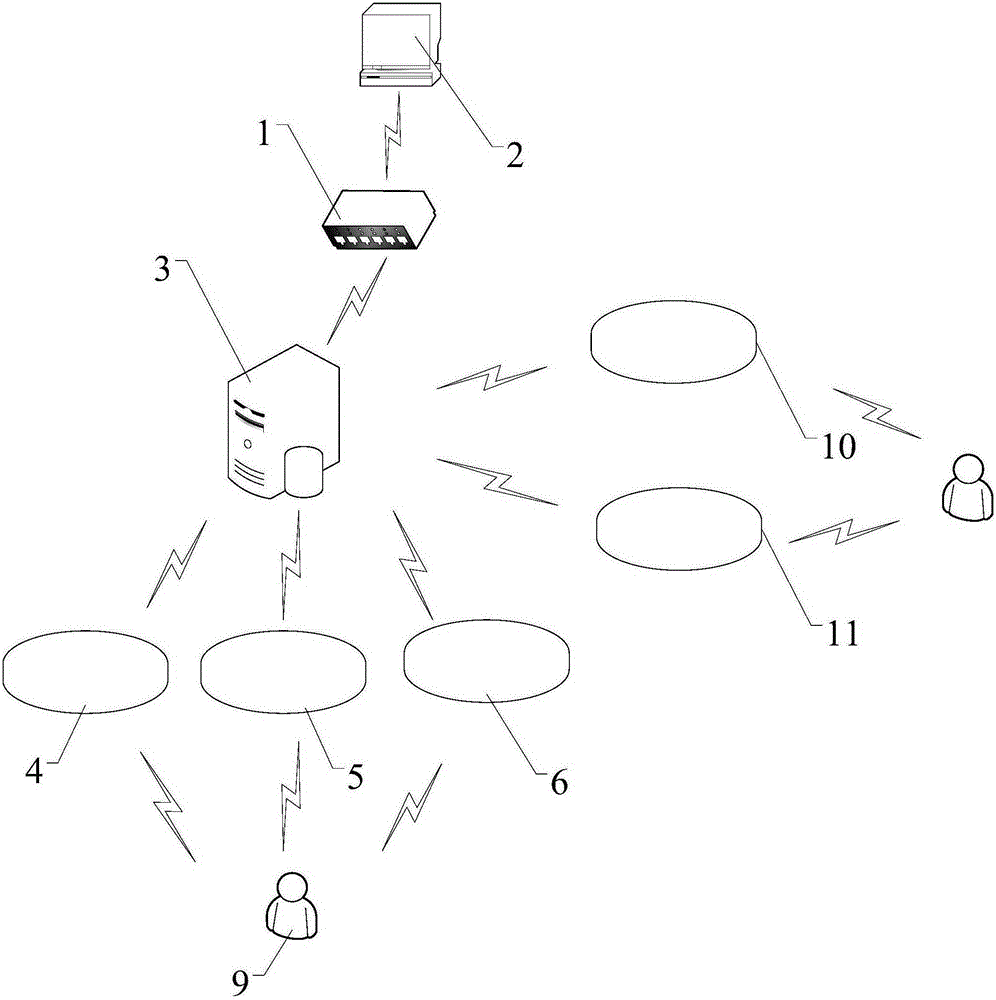

Stock information push system and push method

InactiveCN106056449AReceive comprehensiveReduce distanceFinanceWebsite content managementInformation processingWeb application

The invention provides a stock information push system and push method. The stock information push system comprises a management server and a client side. The management server is in communication with a plurality of enterprise servers, a user uses a WEB application program to access the management server through the client side, and the client side comprises a PC terminal and a mobile phone terminal. The management server comprises a database, a data receiving module, a stock information element setting module, a data calculating module, a user behavior obtaining module, an information processing module, a stock screening module and an active pushing module; and the data receiving module, the stock information element setting module, the data calculating module, the user behavior obtaining module, the information processing module, the stock screening module and the active pushing module are in communication with the database. Stock information of an individual stock concerned by a user can be obtained, a concern value can be calculated, and some stocks matching individual stocks having high user concern degrees can be screen out at the same time and be pushed to the user, so the risk of user stock investment is reduced, user investment is no longer blind, the distance between an enterprise and the user is gradually narrowed at the same time, and a win-win effect is possessed.

Owner:黑龙江省容维证券数据程序化有限公司

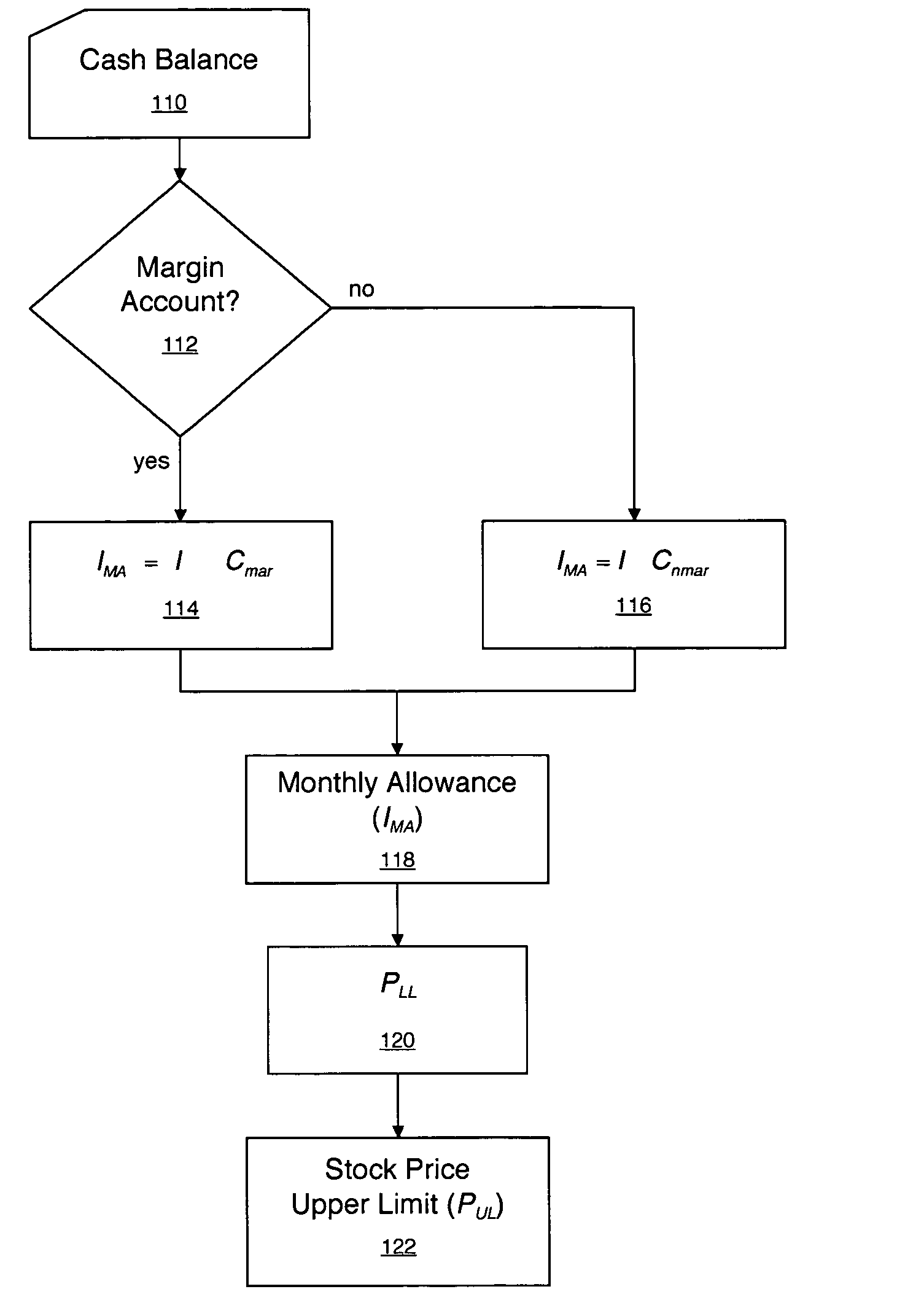

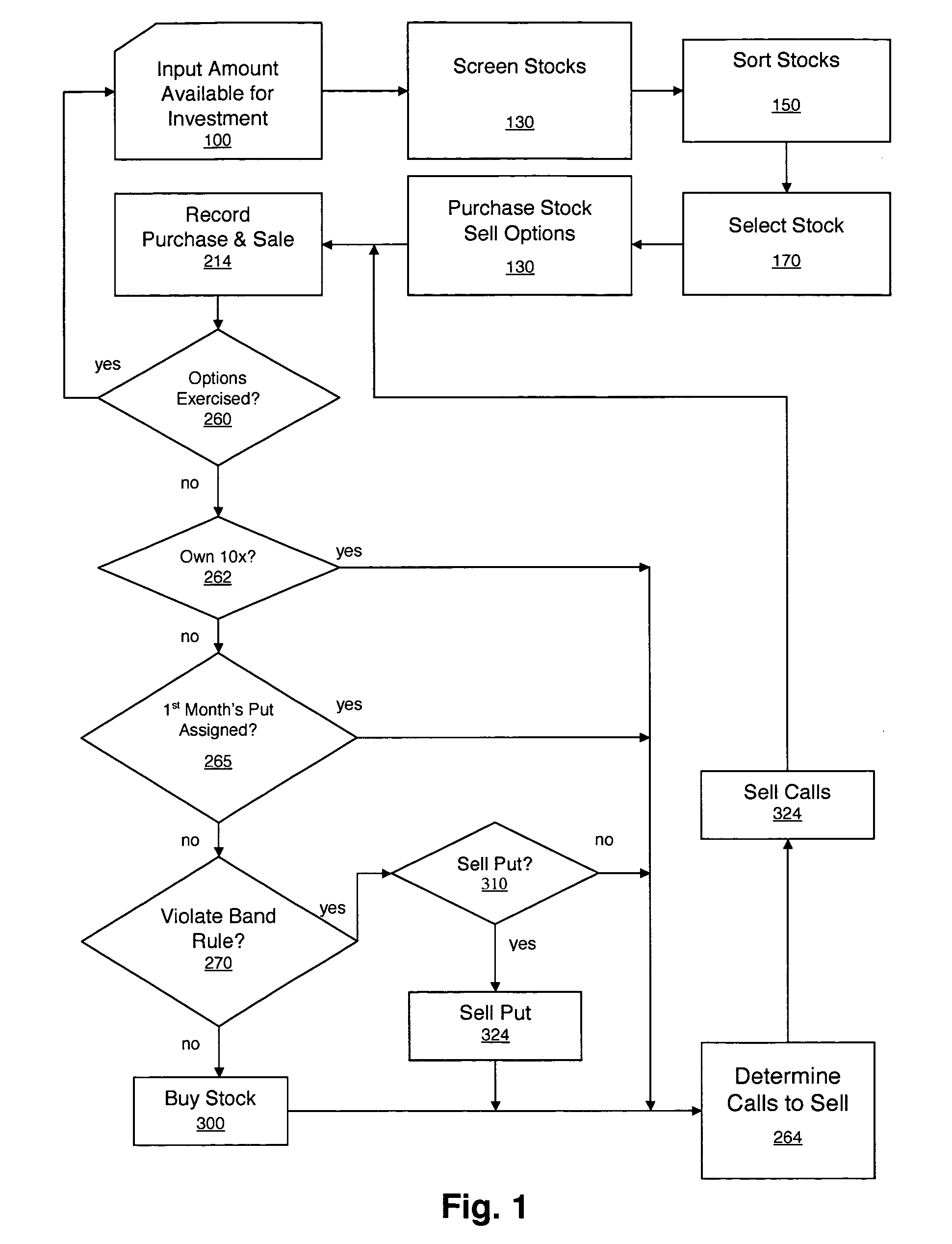

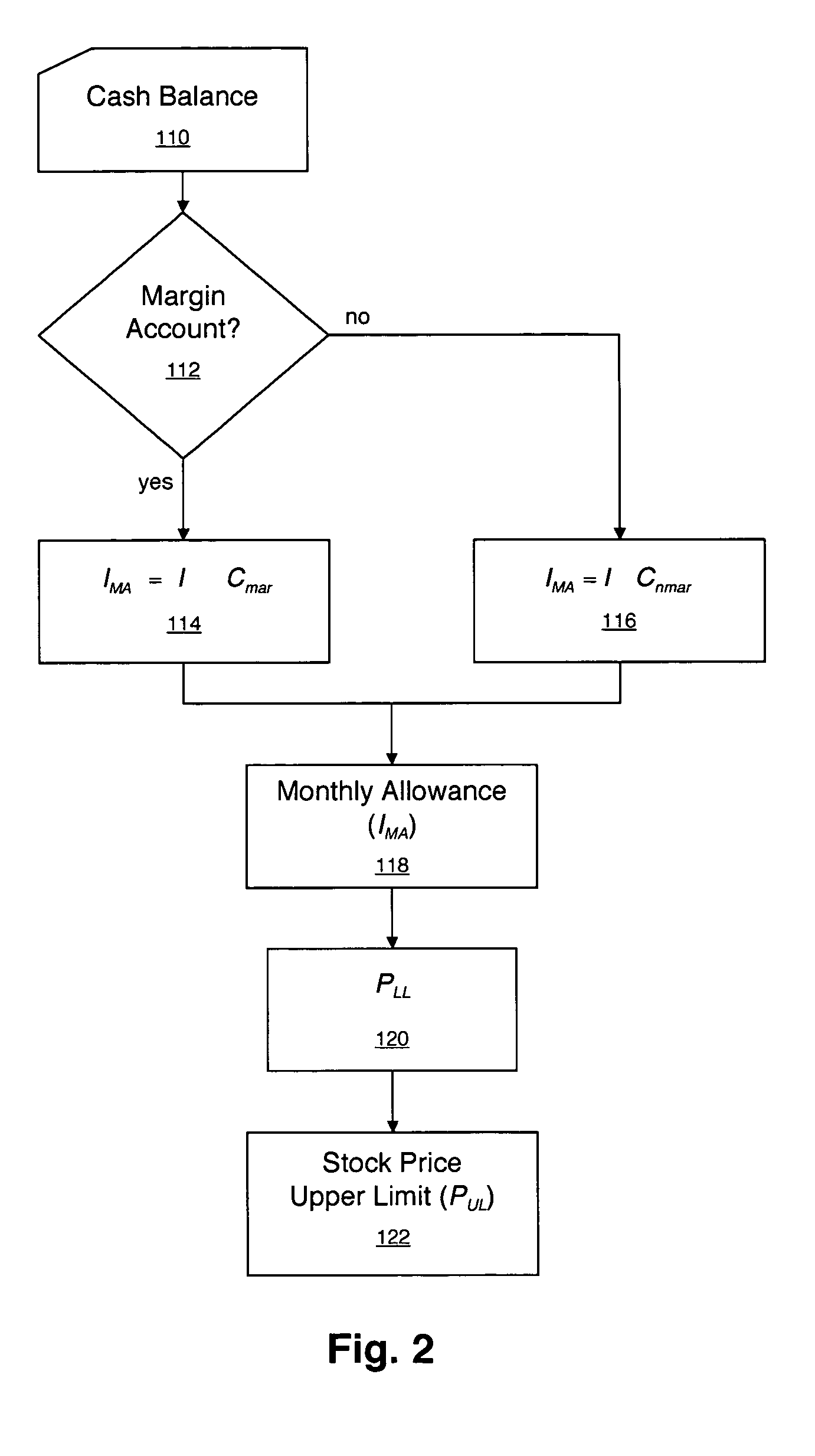

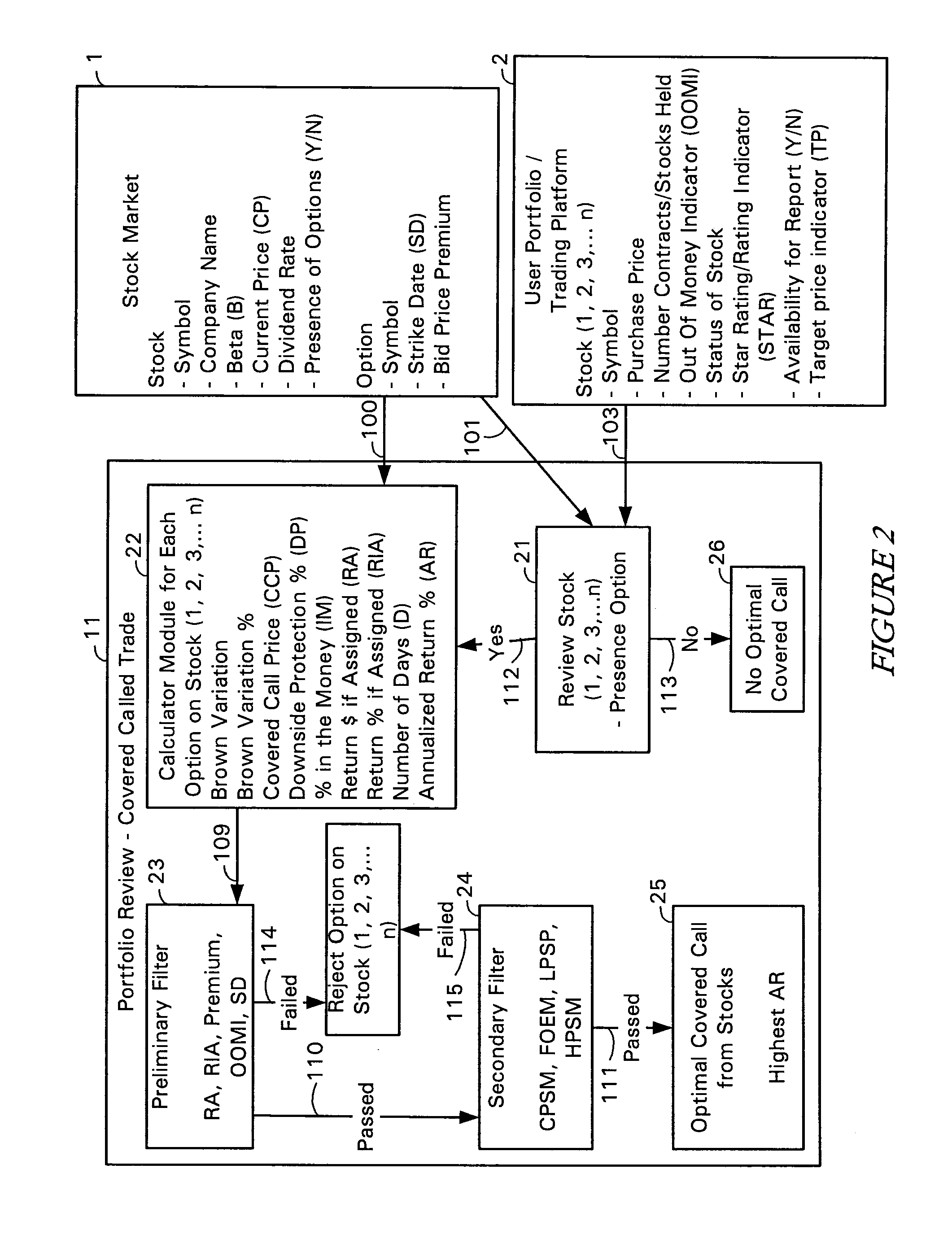

System and method of managing a position in financial stock investments

The present invention provides a system and method for managing a financial investment in a combination of timed purchases of stocks and sale of options. The system and method also relates to the selection of stocks and amount of shares to purchase when to purchase shares and when and how many option contracts to sell concerning the purchased stocks. The system and method also involves the selection of multiple positions in multiple stocks and options for different sized investment funds.

Owner:LITTERARUM PYXIS

Method of constructing a stock index

Computer-implemented methods of creating and maintaining stock indexes are provided. For a stock index of a particular size, a band is defined around the upper and / or lower limits of the stock index. To be added to, or dropped from, a particular stock index, the stocks must fall outside of the bands for that particular stock index size. Stock migration is controlled using a systematic stock migration process so that stocks are gradually added and deleted from an index. Stock investment style is determined in a multi-dimensional process, instead of a linear process. Furthermore, the number of stocks in the stock index need not be a fixed value, but may depend upon how many stocks meet predefined criteria at any given point in time.

Owner:SIEMENS AG +1

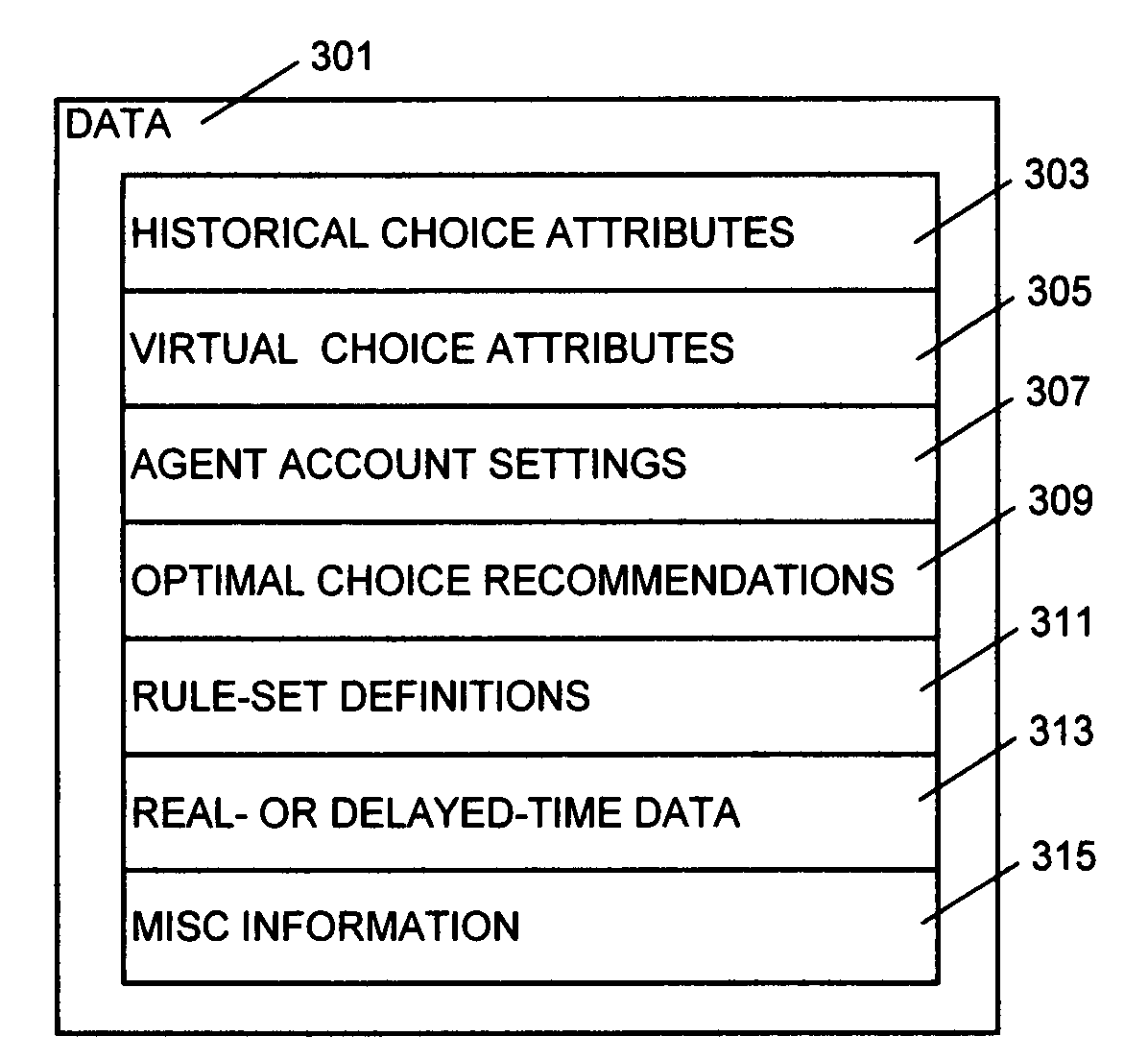

Method and system for optimal choice

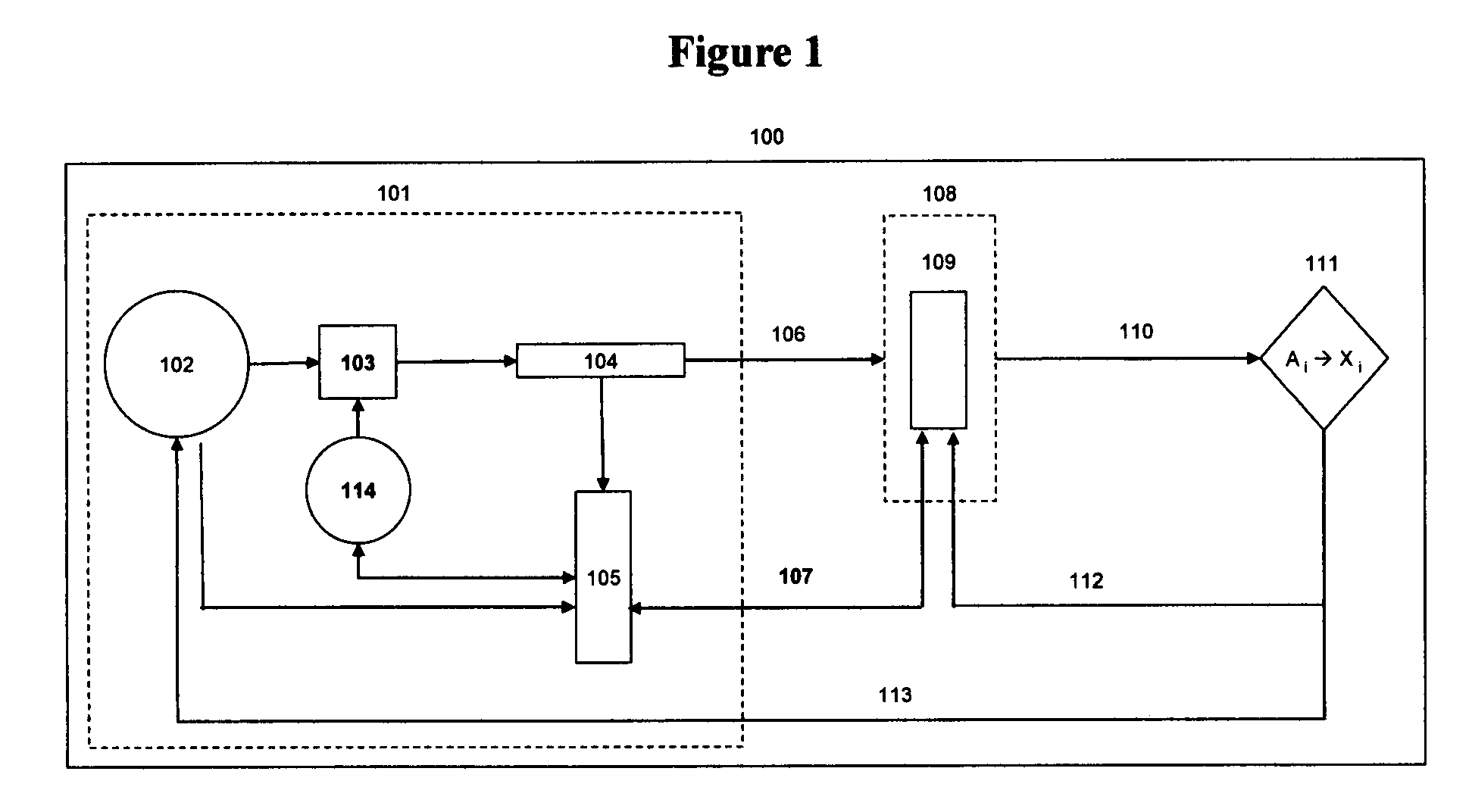

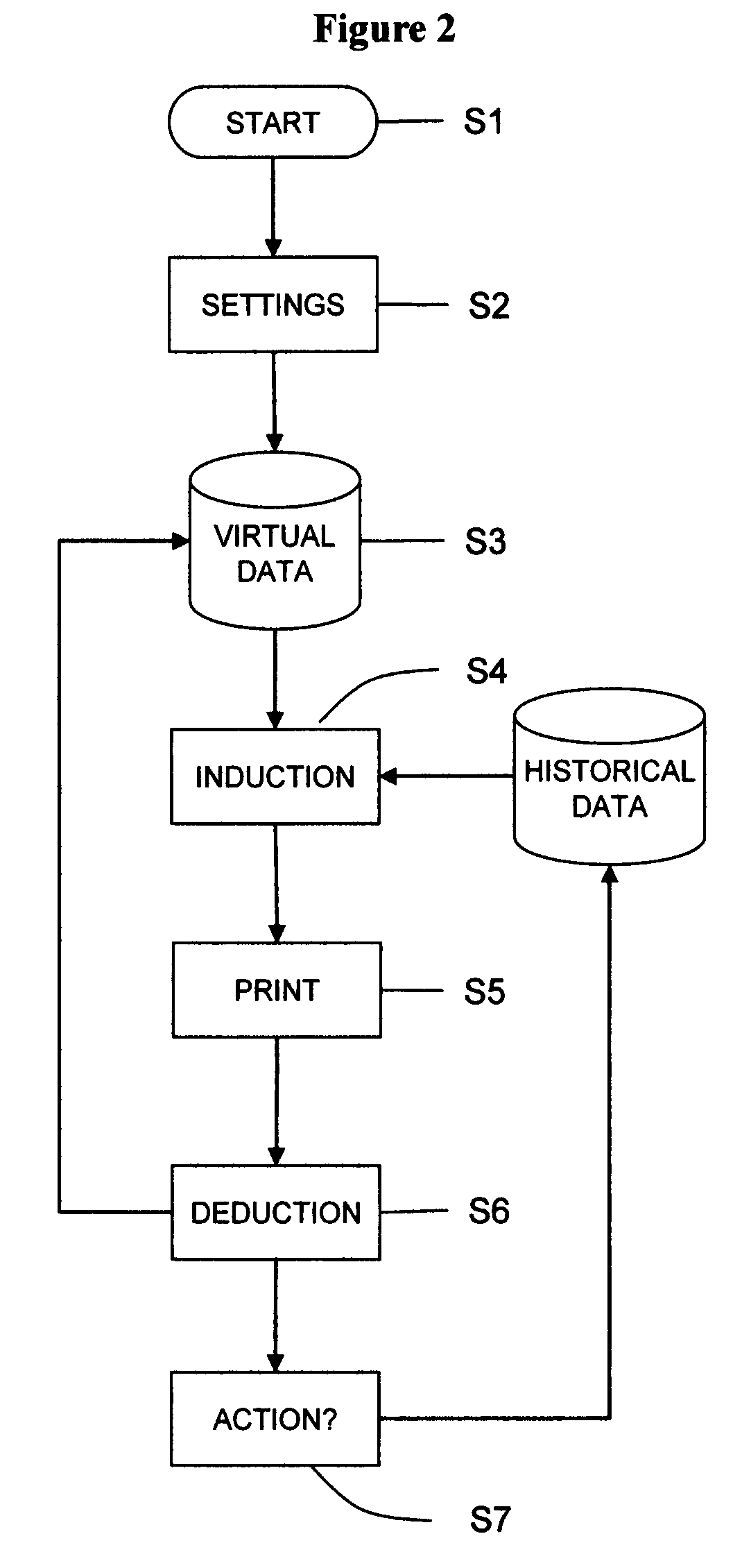

InactiveUS20090076988A1Digital computer detailsProbabilistic networksObject functionInductive database

A method and system for optimal choice is described. An inductive database system uses an integration of historical data and virtual data (in the form of intuitive rule-sets specified by an agent or plurality of agents) to make statistical recommendations for optimal choice. Filter mechanisms support the reporting of choice recommendations and user interaction with historical data. In the latter case, user interaction with a deductive interface allows for the testing of decision criteria or rule-sets against an historical database and empirical target results. The constant testing of ideas against an objective function provides an update methodology for a database of virtual data and provides a training methodology for the user. An example of picking stock investments is given.

Owner:STANELLE EVAN J

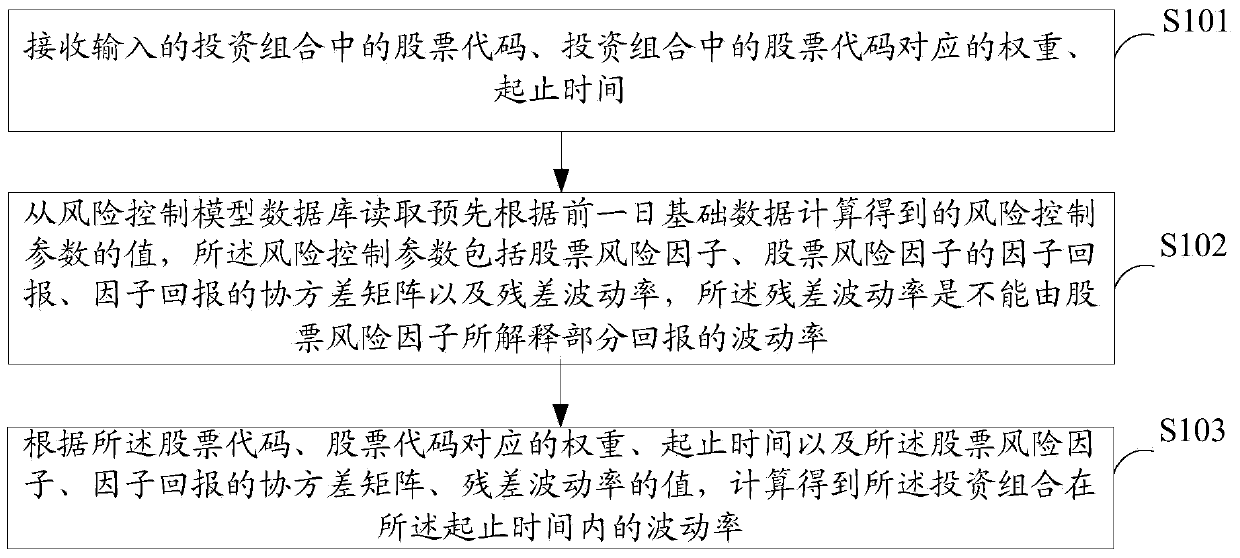

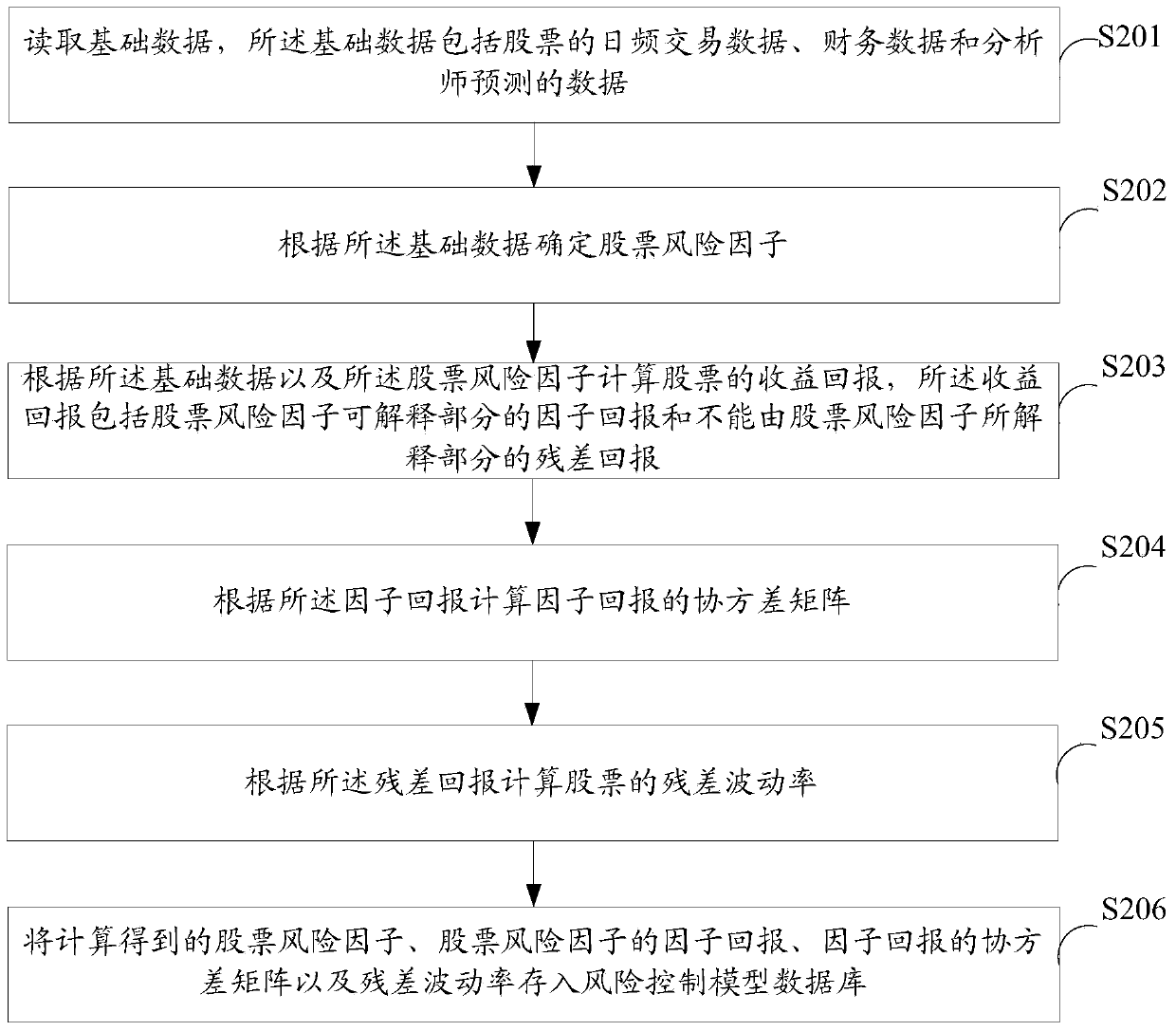

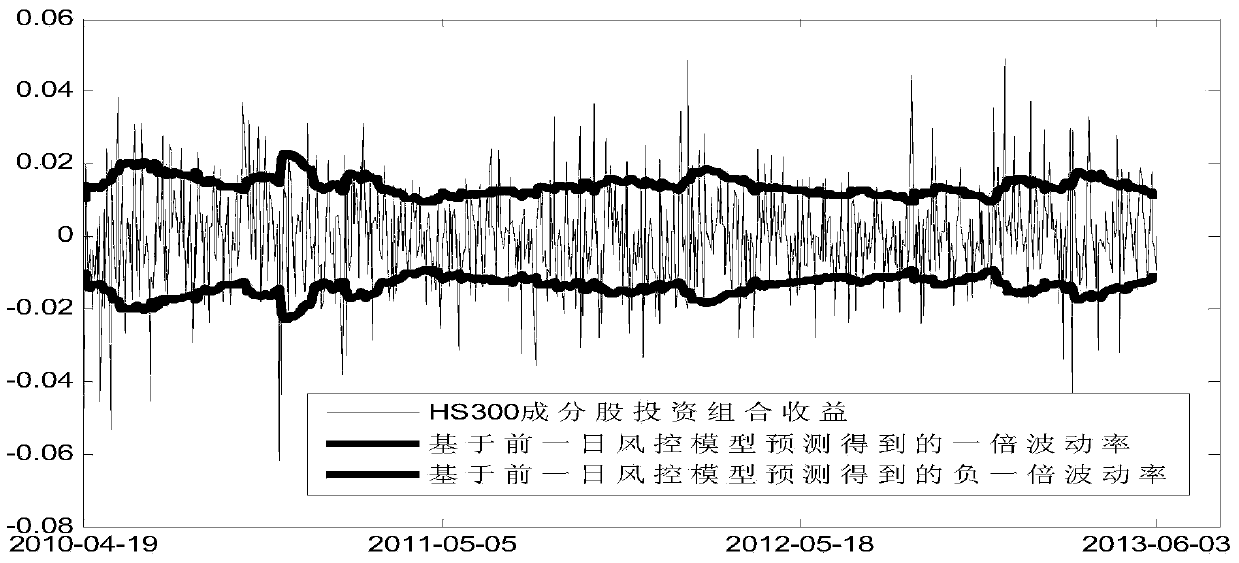

Stock or stock investment portfolio volatility prediction method and device

ActiveCN103455943AReduce computing timeImprove calculation accuracyFinanceRisk ControlInformation processing

The invention belongs to the technical field of information processing, and provides a stock or stock investment portfolio volatility prediction method and device. The stock or stock investment portfolio volatility prediction method comprises the steps of receiving stock codes in an input investment portfolio, and weight, beginning time, and ending time corresponding to the stock codes in the investment portfolio, reading values of risk control parameters, obtained in advance according to calculation of basic data yesterday, from a risk control model data base, and obtaining the volatility of the investment portfolio within the beginning and ending time through calculation according to the stock codes, and the weight, the beginning time and the ending time corresponding to the stock codes, stock risk factors, a covariance matrix of factor return and the value of the residual volatility, wherein the risk control parameters comprise the stock risk factors, the factor return of the stock risk factors, the covariance matrix of the factor return and the residual volatility, and the residual volatility is the volatility of the part, cannot be explained by the stock risk factors, of the return. By means of the stock or stock investment portfolio volatility prediction method and device, the time for calculating the volatility is greatly reduced and the calculation accuracy is higher.

Owner:深圳希施玛数据科技有限公司

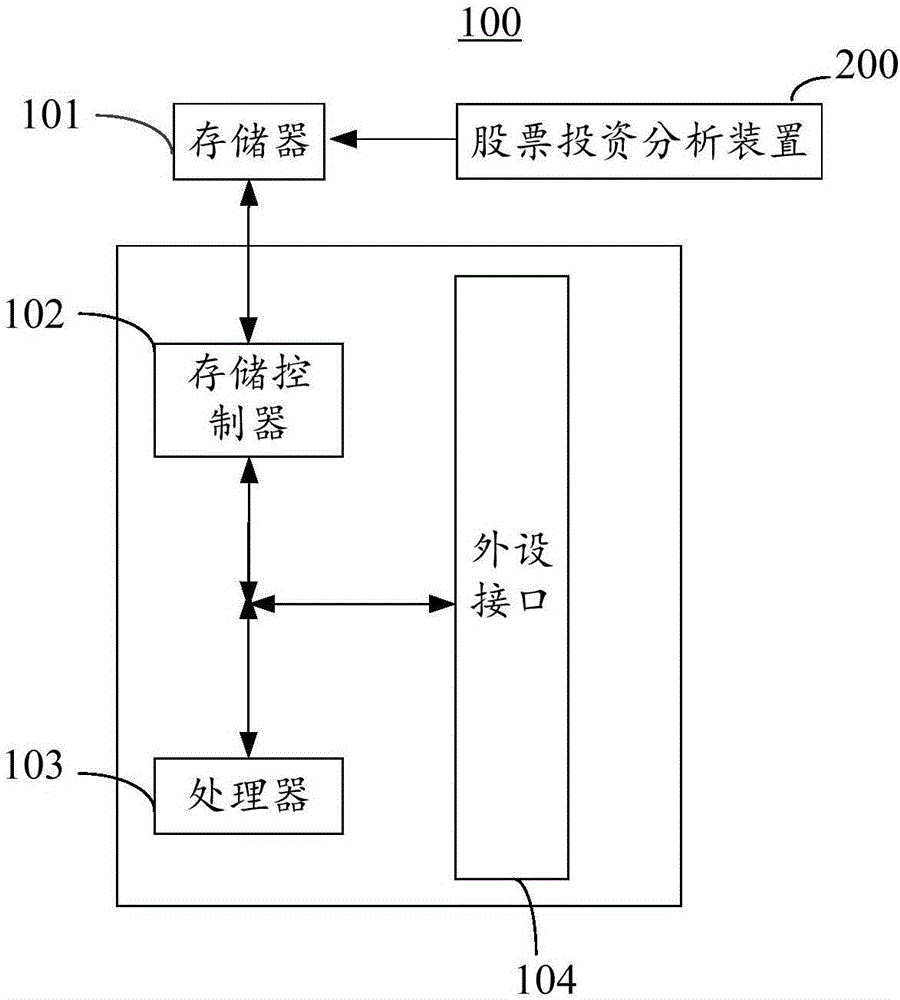

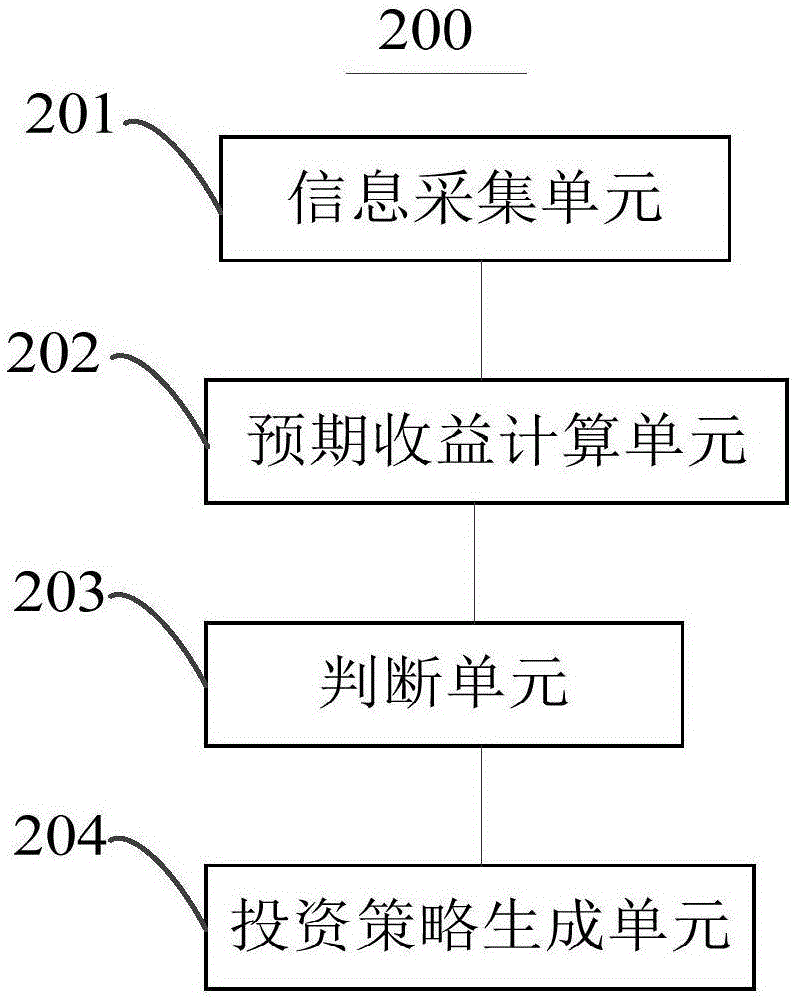

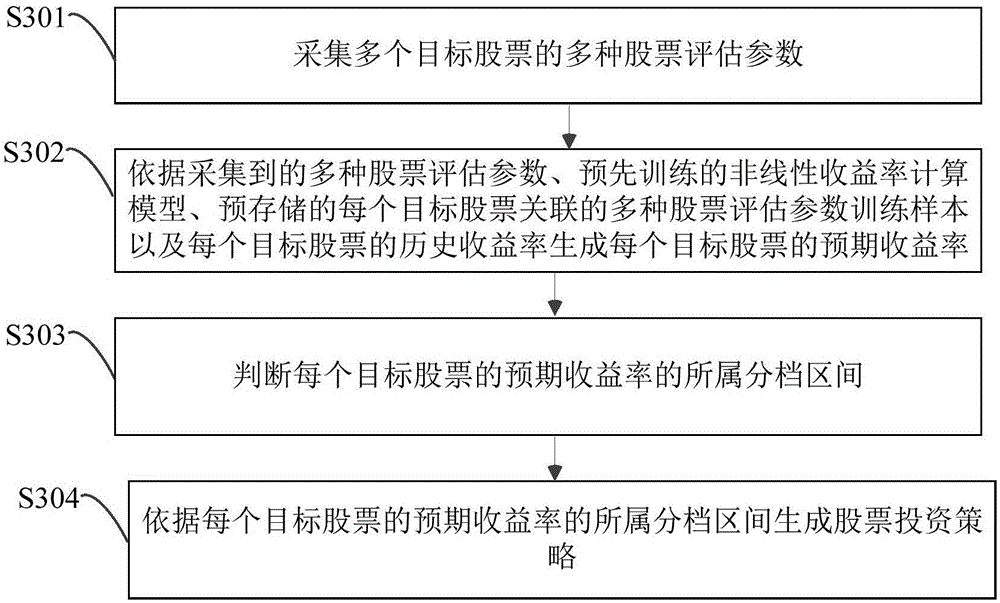

Stock investment analyzing device and stock investment analyzing method

InactiveCN107437227AEarnings are accurateHigh reference valueFinanceComputational modelDependability

Owner:TIANHONG ASSET MANAGEMENT CO LTD

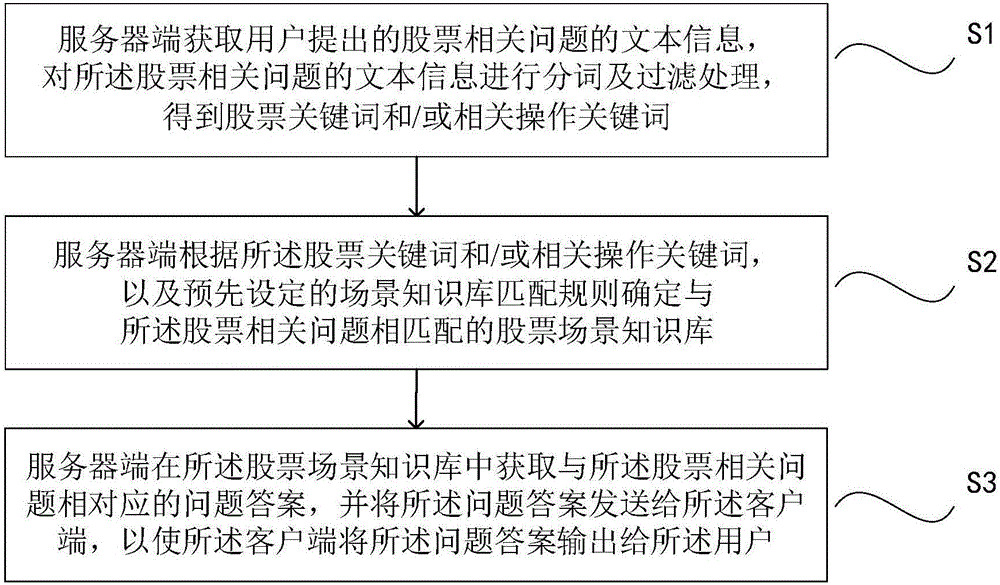

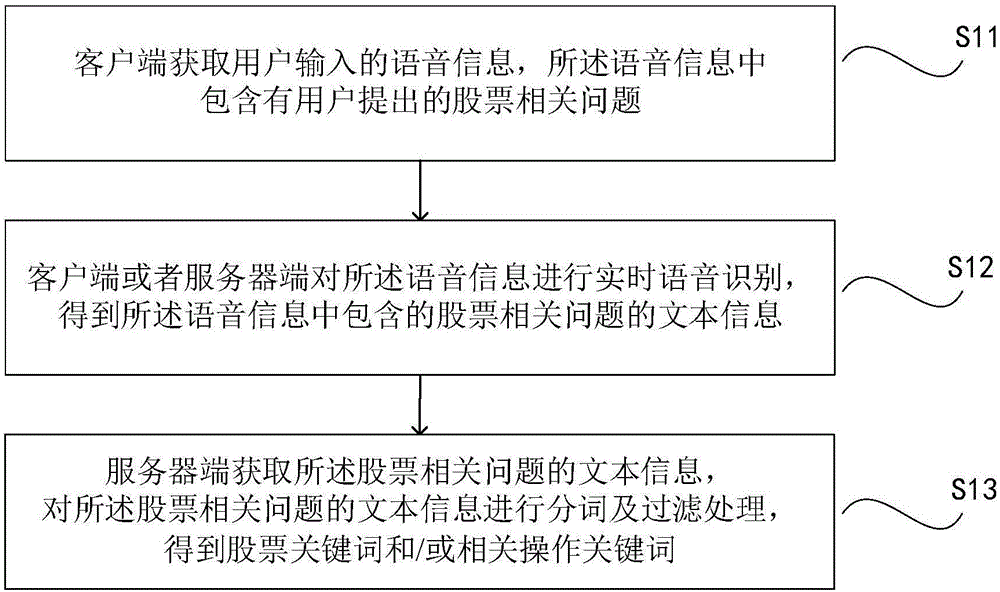

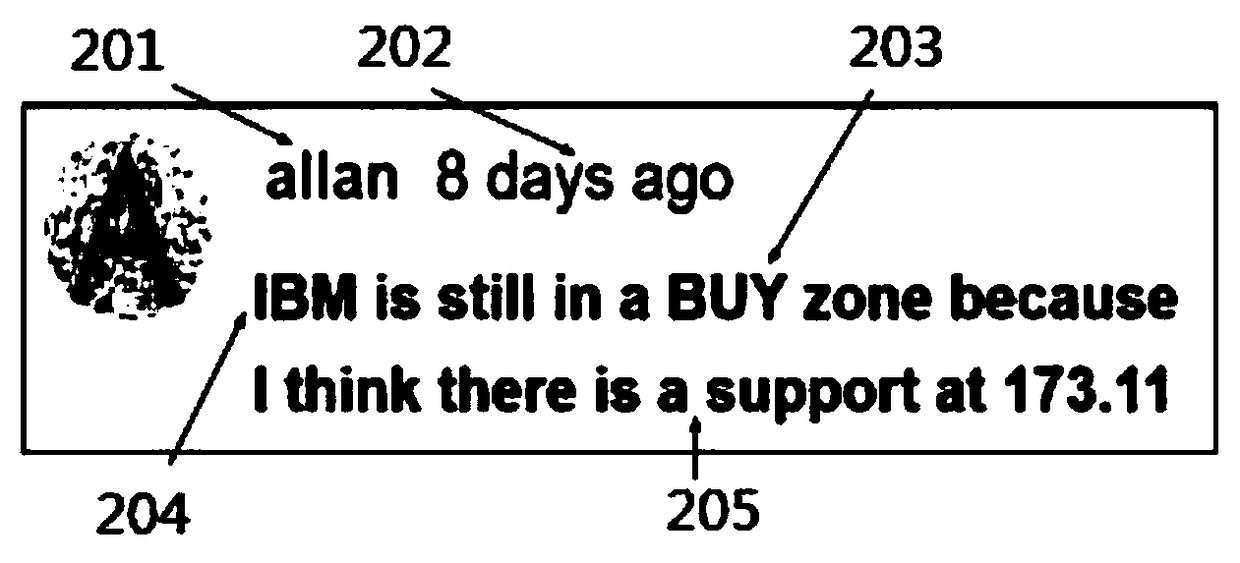

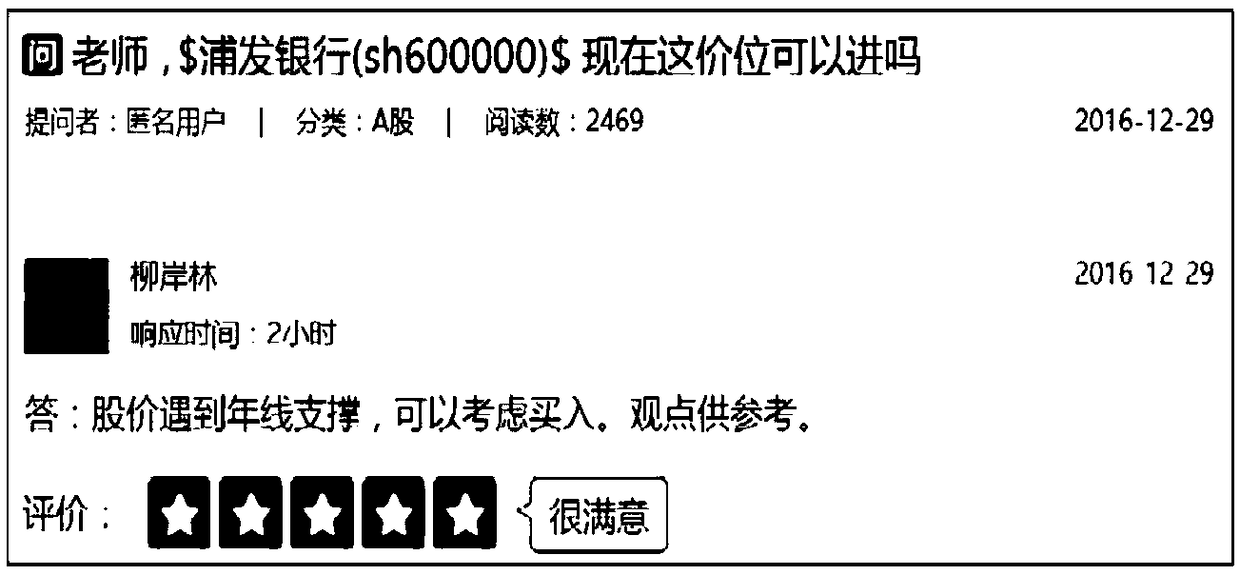

Intelligent stock investment adviser questioning-answering interaction method and intelligent stock investment adviser questioning-answering interaction system

InactiveCN106682137AAutomate accurate answersReduce labor costsFinanceKnowledge representationInteraction systemsFiltration

The invention discloses an intelligent stock investment adviser questioning-answering interaction method. The method includes that a server side acquires text information of stock-related problems put forward by a user, and the text information of the stock-related problems is subjected to word segmentation and filtration so as to obtain stock keywords and / or related operation keywords; the server side determines a stock scene knowledge base matching with the stock-related problems according to the stock keywords and / or the related operation keywords as well as preset scene knowledge base matching rules; the server side acquires corresponding answers of the stock-related problems from the stock scene knowledge base and sends the answers to a client side, so that the client side outputs the answers to the user. The intelligent stock investment adviser questioning-answering interaction method has the advantages that the user problems can be answered automatically accurately, so that labor cost of investment advisers is saved; answering pertinence and accuracy can be improved, so that users can obtain more accurate and valuable information.

Owner:武汉市灯塔互动文化传播有限公司

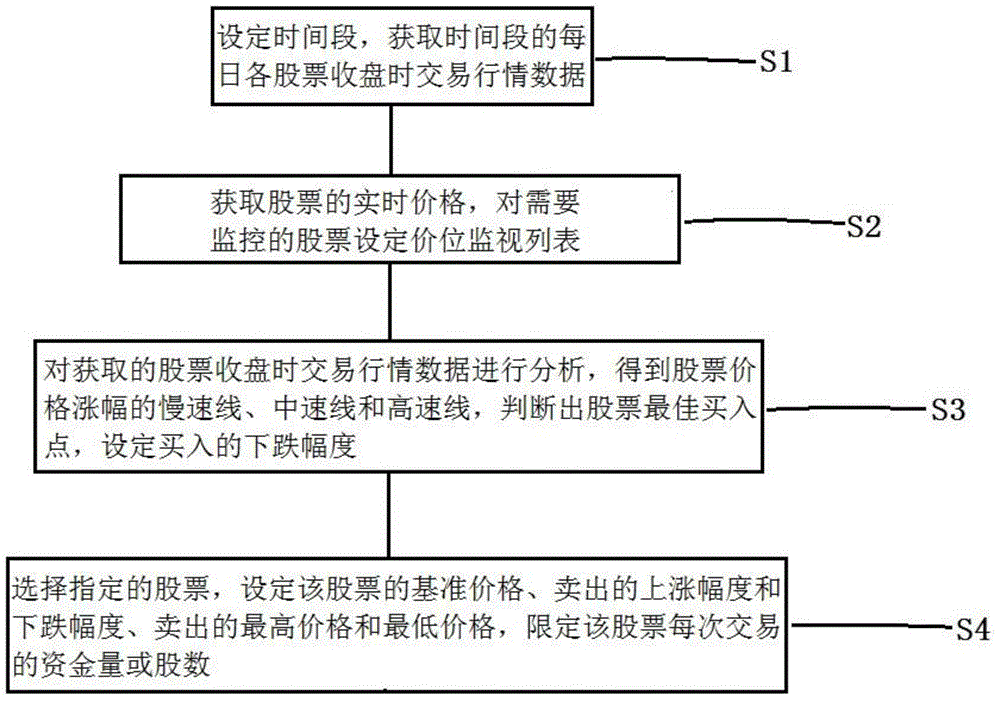

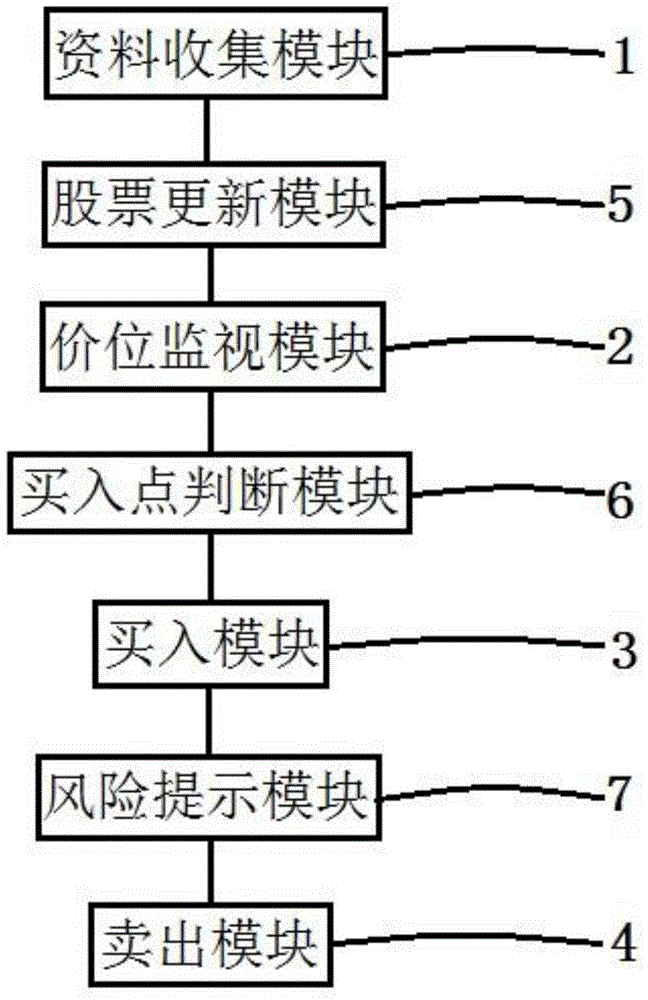

Individual stock buying-selling method and system of stock investment

The invention discloses an individual stock buying-selling method and system of stock investment. The individual stock buying-selling method comprises the following steps that a time period is set, and exchange quotation data of different stocks during closing everyday within the time period is obtained; real-time prices of stocks are obtained, and a price monitoring list is set for stocks which need monitoring; the obtained exchange quotation data of the stocks during closing is analyzed to obtain high-speed, intermediate-speed and high-speed increasing lines of the stock prices, optimal buying points of the stocks are determined, and the downside amplitudes of buying are set; and a specific stock is selected, the reference price, the upside and downside selling amplitudes and the highest and lowest selling prices of the stock are set, and the amount of money or the amount of stocks in each transaction of the stock is limited. The individual stock buying-selling system of stock investment can improve the benefits and reduce the transaction risk.

Owner:上海华颂软件科技有限公司

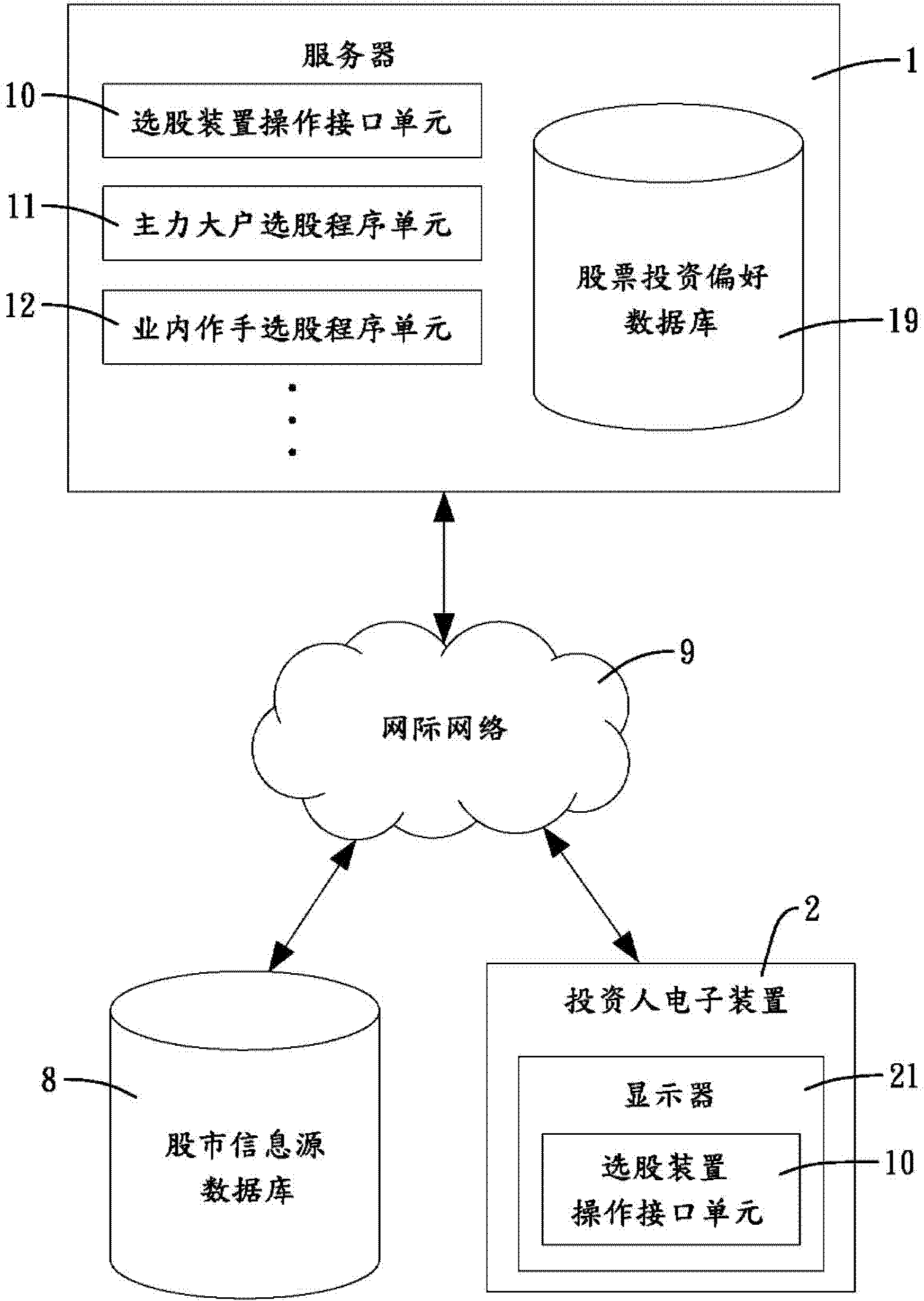

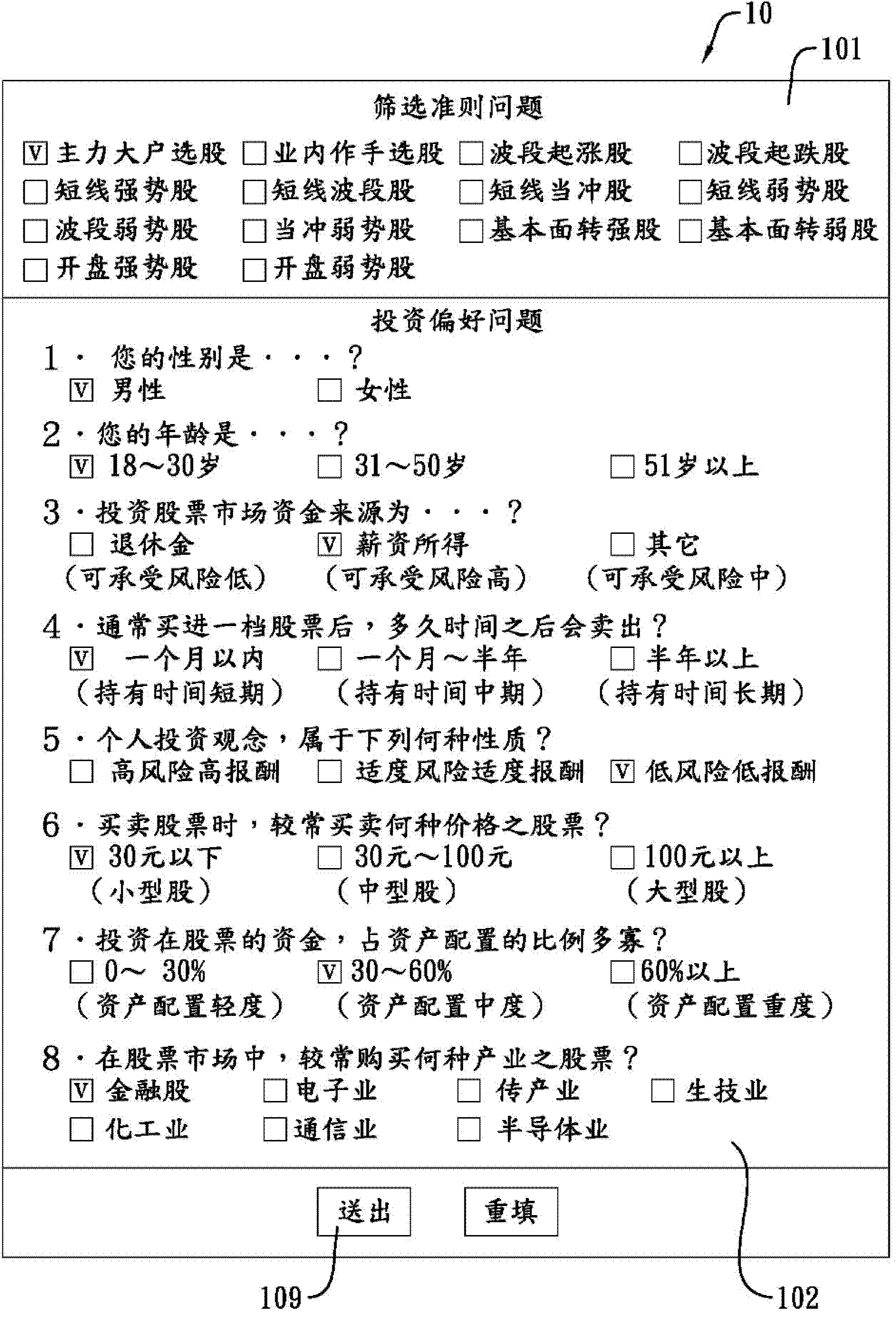

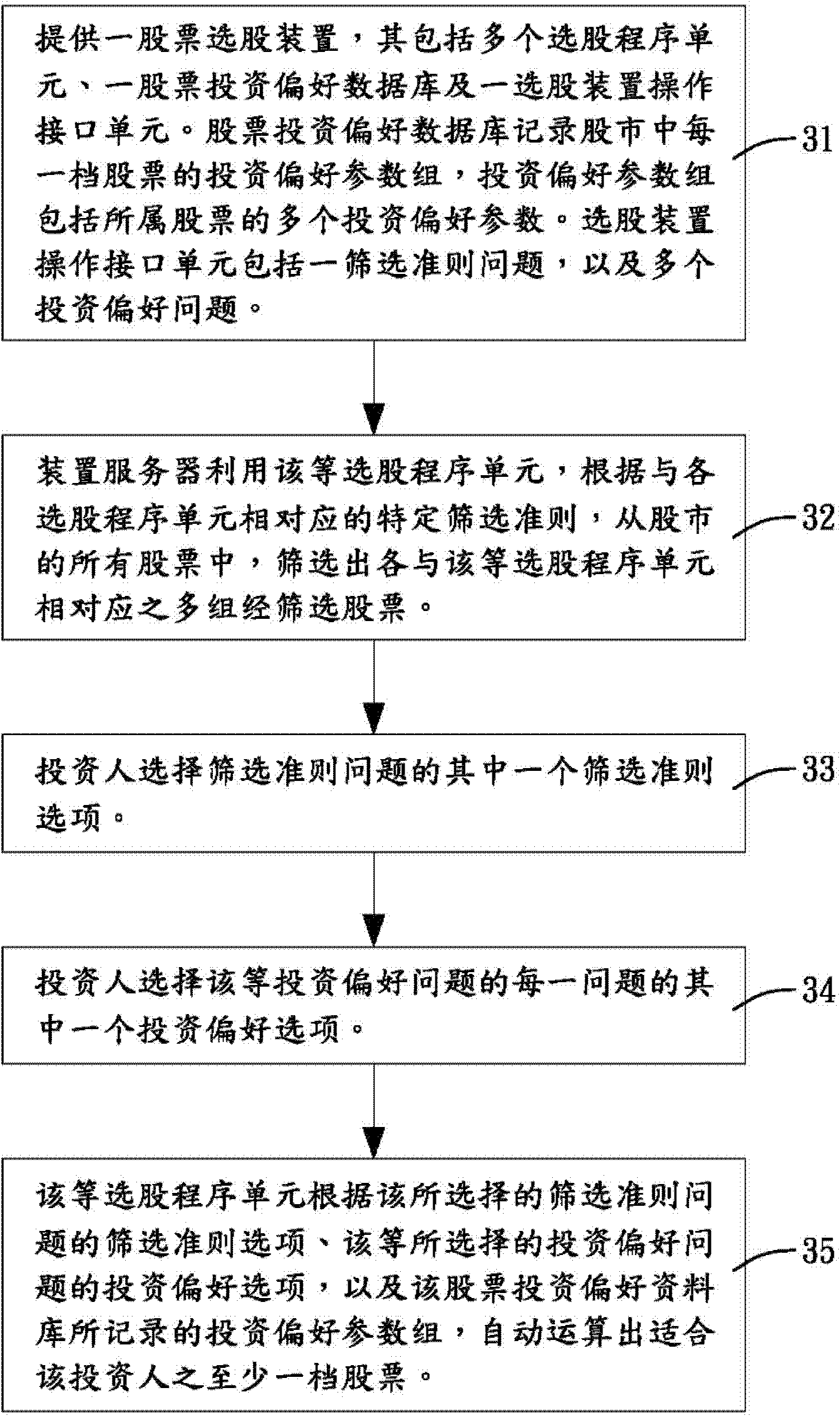

Stock selection device and method

The invention relates to a stock selection device and method. The stock selection device comprises a plurality of stock selection program units, a stock investment preference database and a stock selection device operation interface unit. Each stock selection program unit screens a plurality of groups of screened stocks corresponding to the stock selection program unit from all stocks in the stock market according to a corresponding screening principle; the stock investment preference database records the investment preference parameter group of each file stock in the stock market, wherein the investment preference parameter group comprises a plurality of investment preference parameters of the stock; and the stock selection device operation interface unit comprises a plurality of investment preference questions, and each investment preference question corresponds to a corresponding investment preference parameter of the investment preference parameter group of the stock in the stock investment preference database and is provided with a plurality of investment preference options. After an investor inputs an investment preference option for every investment preference question, the plurality of stock selection units operate at least one stock applicable to the investor according to the investment preference options input by the investor and the investment preference parameter group recorded in the stock investment preference database.

Owner:孙武仲

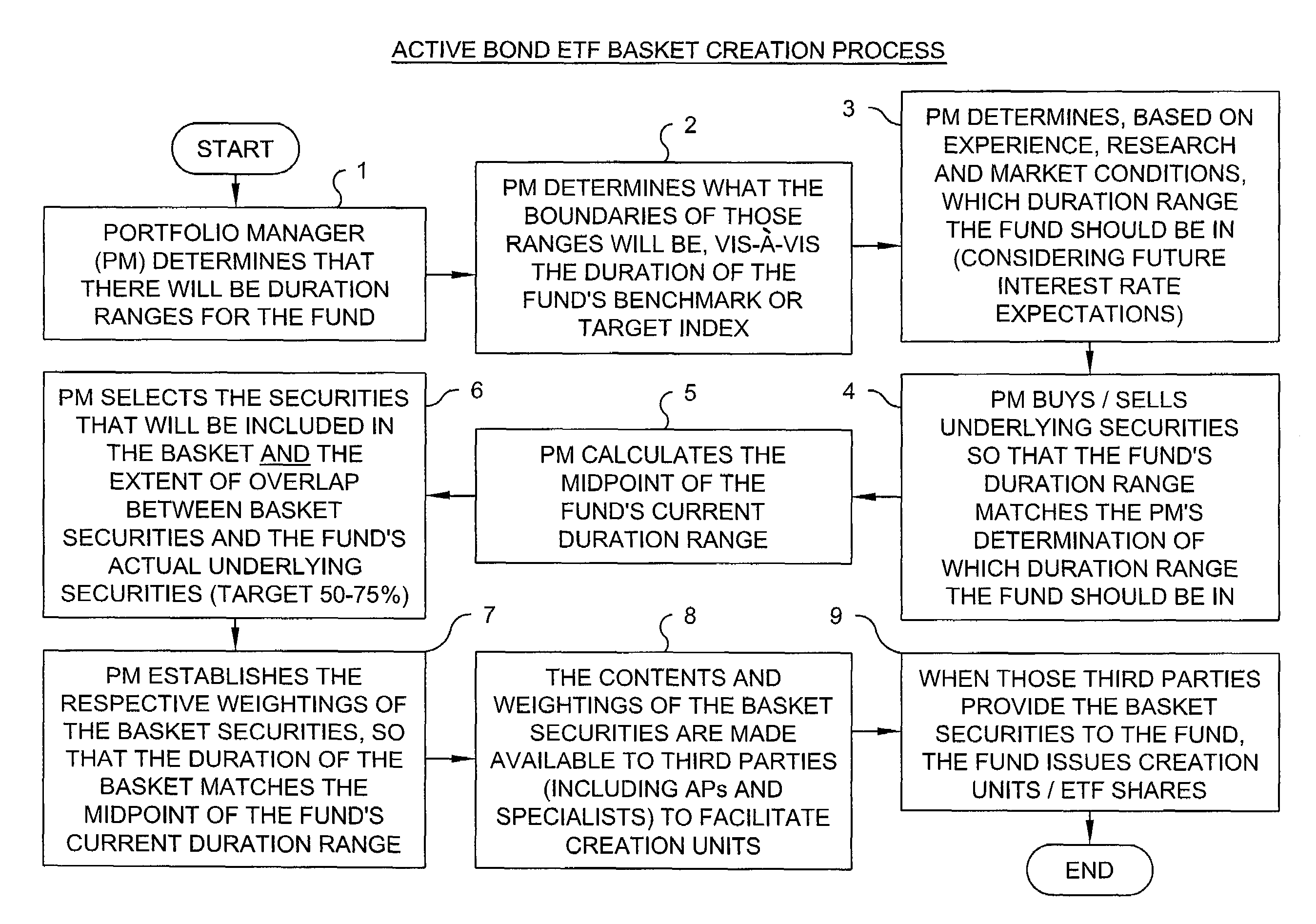

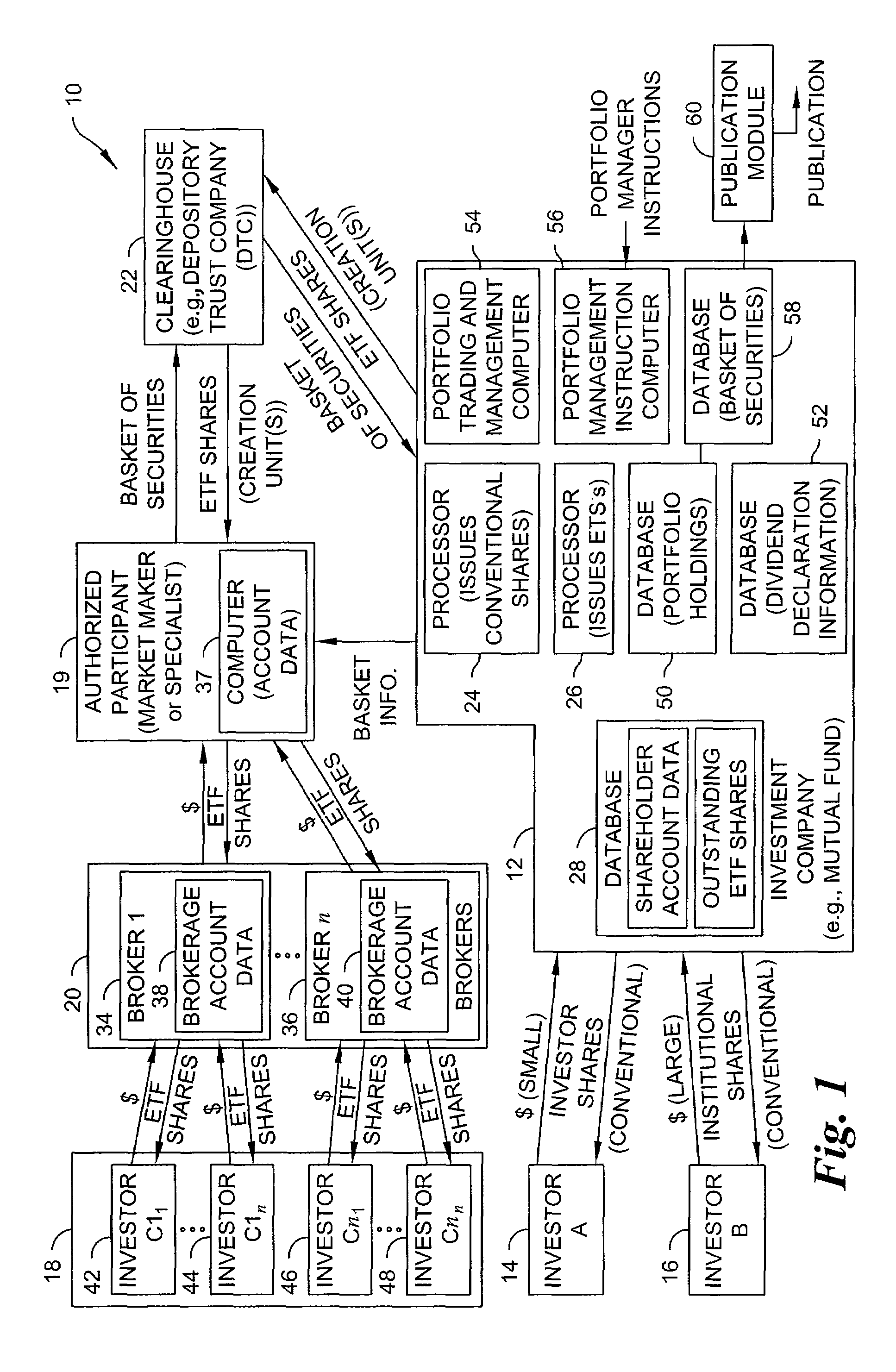

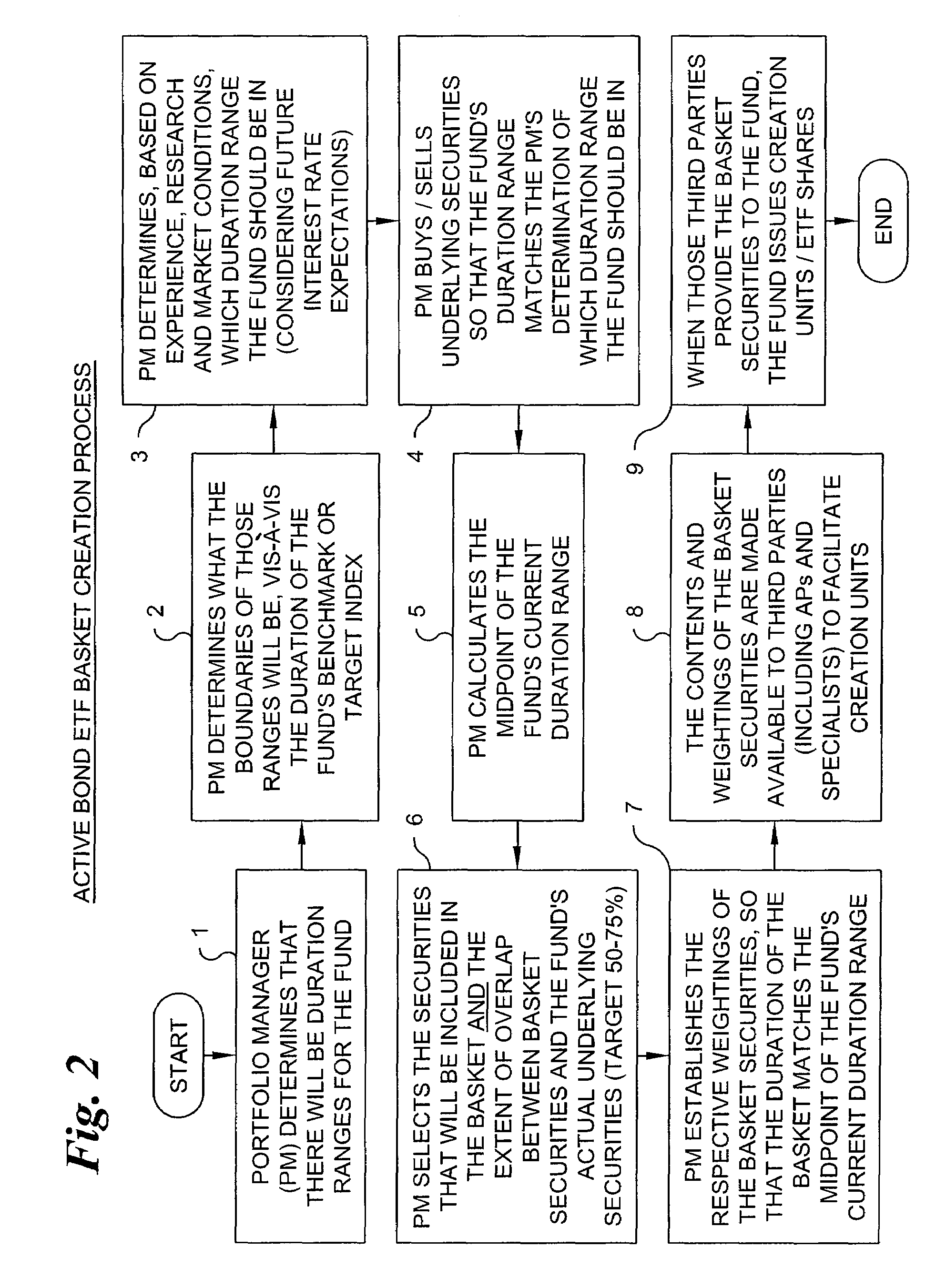

Basket creation process for actively managed ETF that does not reveal all of the underlying fund securities

Owner:THE VANGUARD GROUP

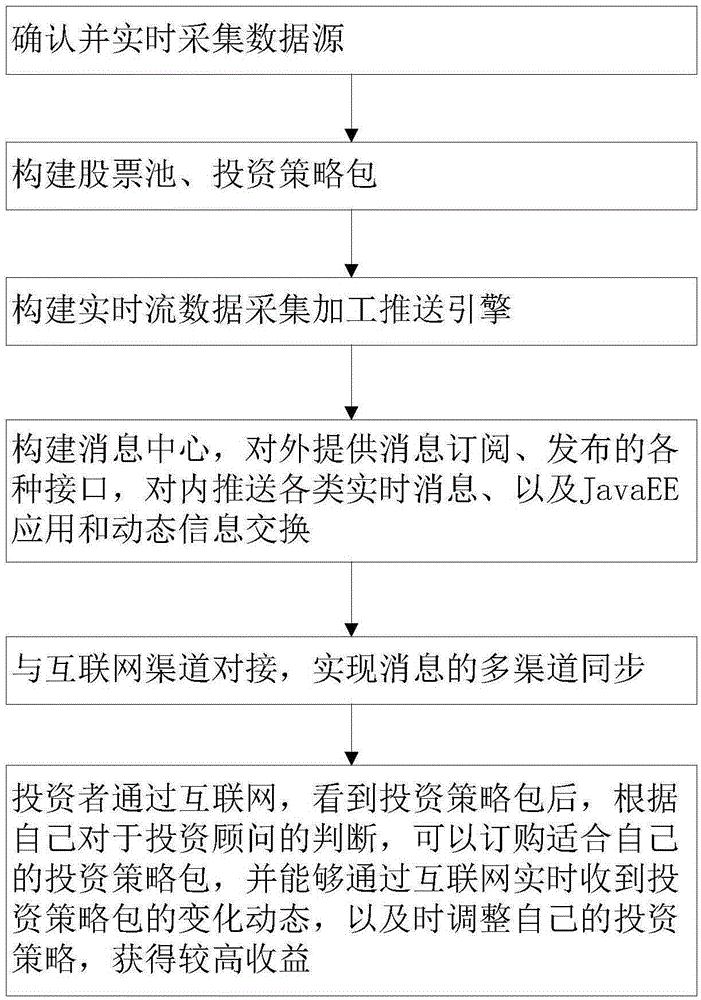

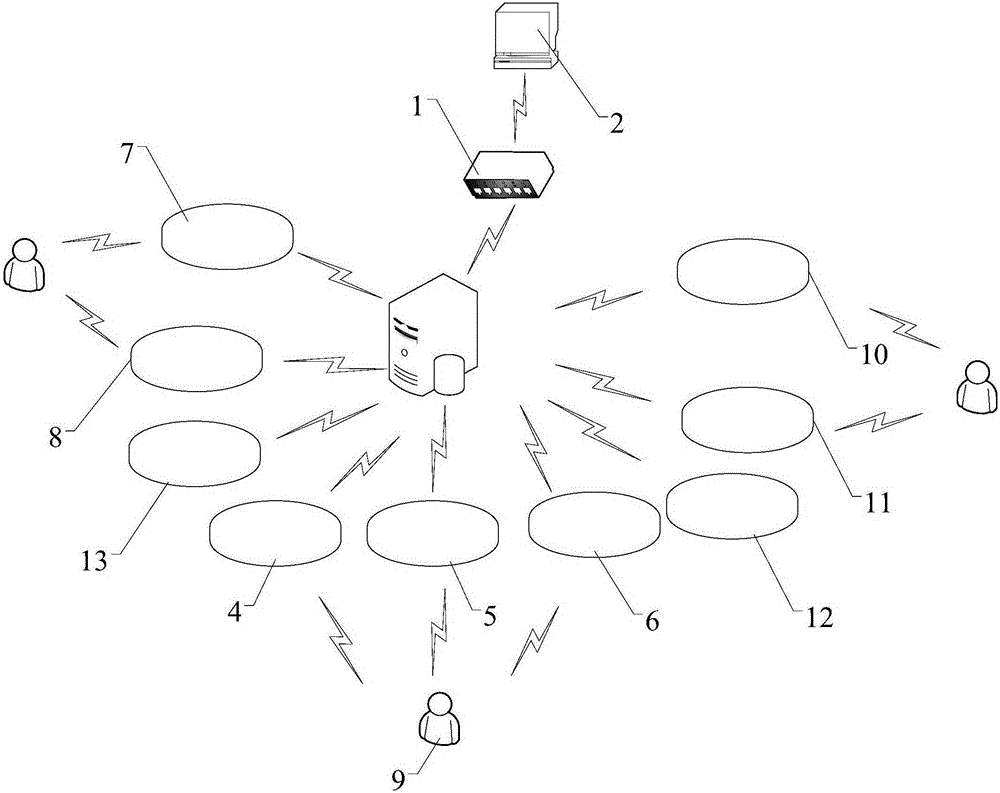

Stock investment method and stock investment system

InactiveCN105303443AAchieve synchronizationIncrease incomeFinanceData switching networksTotal investmentInterconnection

The invention discloses a stock investment method and a stock investment system. A stock pool and an investment strategy package are established according to the risk appetite and the operation habit of an investor. Furthermore according to appropriate management, the stock pool and the investment strategy package are displayed to the matched investor through a website, Wechat or short messages. After the investor observes the strategy package or the dynamic change through the website, Wechat or the short messages, according to judgment himself to an investment adviser, the investor orders the investment strategy package which is suitable for the investor, thereby adjusting the investment strategy himself in time. The stock investment method and the stock investment system have advantages of constructing interconnection and intercommunication between the investment adviser and the investor, realizing direct arrival of the service of the investment adviser to the investor, realizing ms-grade real-time synchronous data pushing, helping the investor to quickly handle quotation change, greatly reducing time cost and phone expense cost in communication, and realizing replacement for artificial service.

Owner:SUZHOU INDAL PARK LINKAGE SOFTWARE

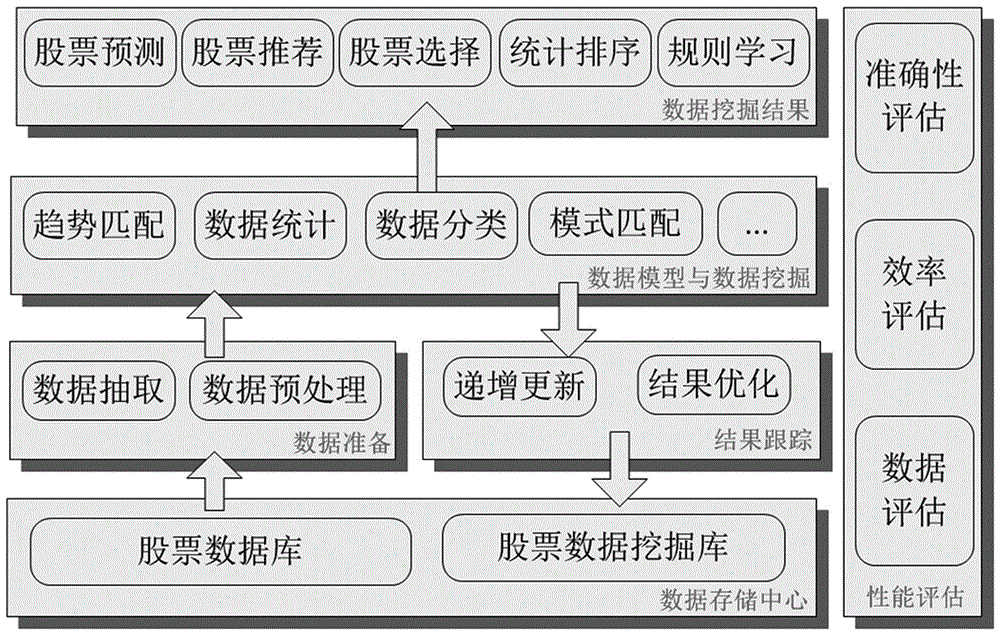

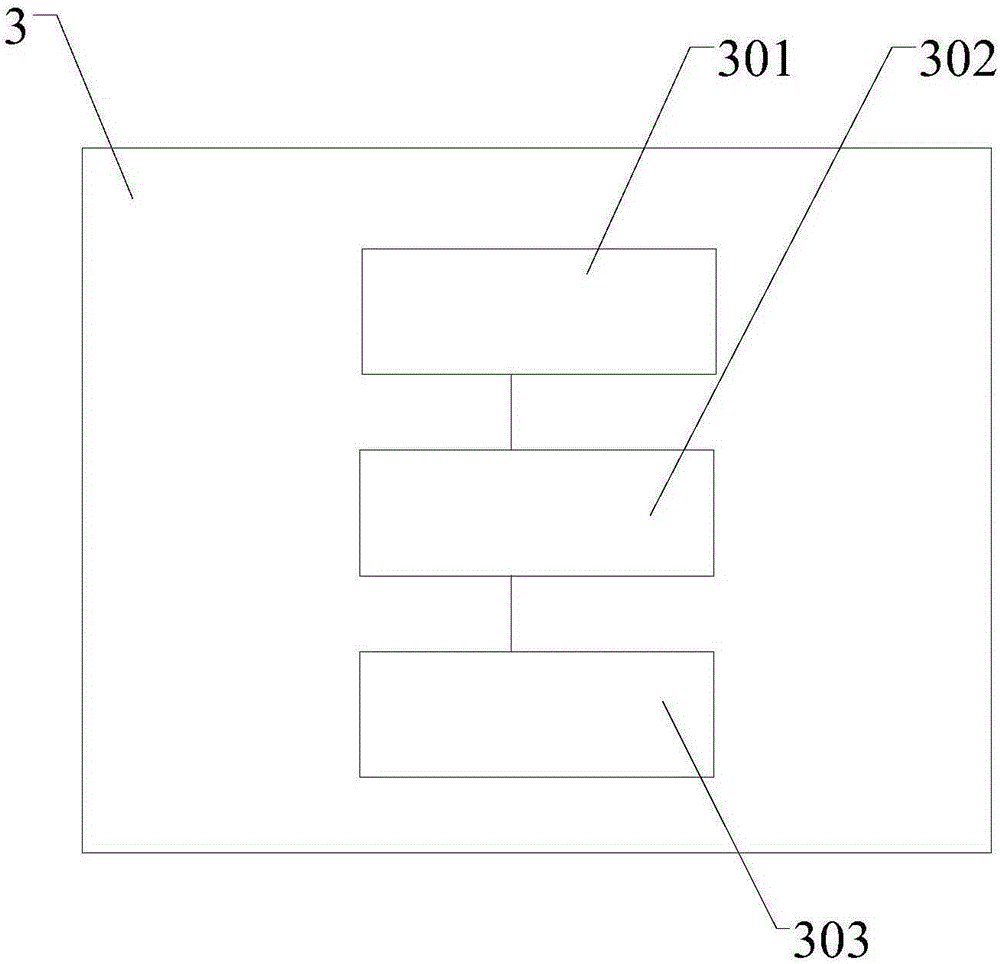

Stock data excavation model based on history repeat and system

The invention discloses a stock data excavation model based on a history repeat, and a system. The model searches and finds valuable information from massive stock historical trend lines based on the idea that history will be repeated. The constructed stock data excavation model comprises 6 core modules of a data storage center module, a data preparation module, a data model and data excavation module, a data excavation result module, a result tracking module and a performance evaluation module. Based on the provided model, a multifunctional and highly expandable stock big data excavation system can be constructed. In this system, rapid test and practice of a stock excavation method can be facilitated on one hand, and on the other hand, assisting decision making support can be provided for a user to carry out stock investment.

Owner:洪志令

Stock information interaction platform and interaction method capable of displaying enterprise information

InactiveCN106485584AIncrease profitabilityReal-time communicationFinanceSpecial data processing applicationsData informationInformation Dissemination

The invention provides a stock information interaction platform and interaction method capable of displaying enterprise information. The interaction platform comprises a data receiving module, a cloud server, a data publishing module, an electronic trading module, a communication interaction module, an enterprise information dissemination module and a browse counting module; and the interaction method comprises the steps as follows: an enterprise terminal transmits enterprise information to the cloud server; the cloud server processes the stored enterprise information into stock data information required by a client; the data publishing module publishes the processed stock data information; and the client retrieves the stock data information and browses the stock data information according to the requirements, and meanwhile, the client and the enterprise terminal achieve interaction. According to the stock information interaction platform provided by the invention, the enterprise information can be comprehensively displayed, the stock investment risk of a user is reduced, real-time communication between an enterprise and the user is also achieved, a market trading platform is provided for the enterprise, a profit platform is provided for the enterprise and the stock information interaction platform has a win-win result.

Owner:黑龙江省容维证券数据程序化有限公司

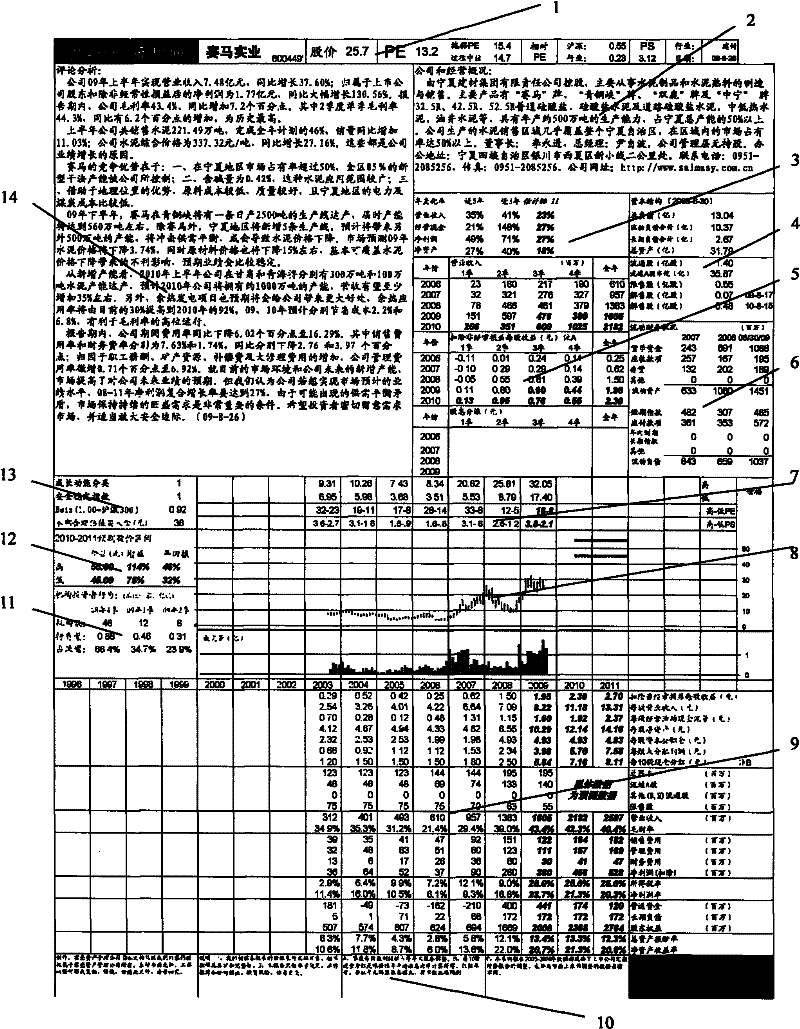

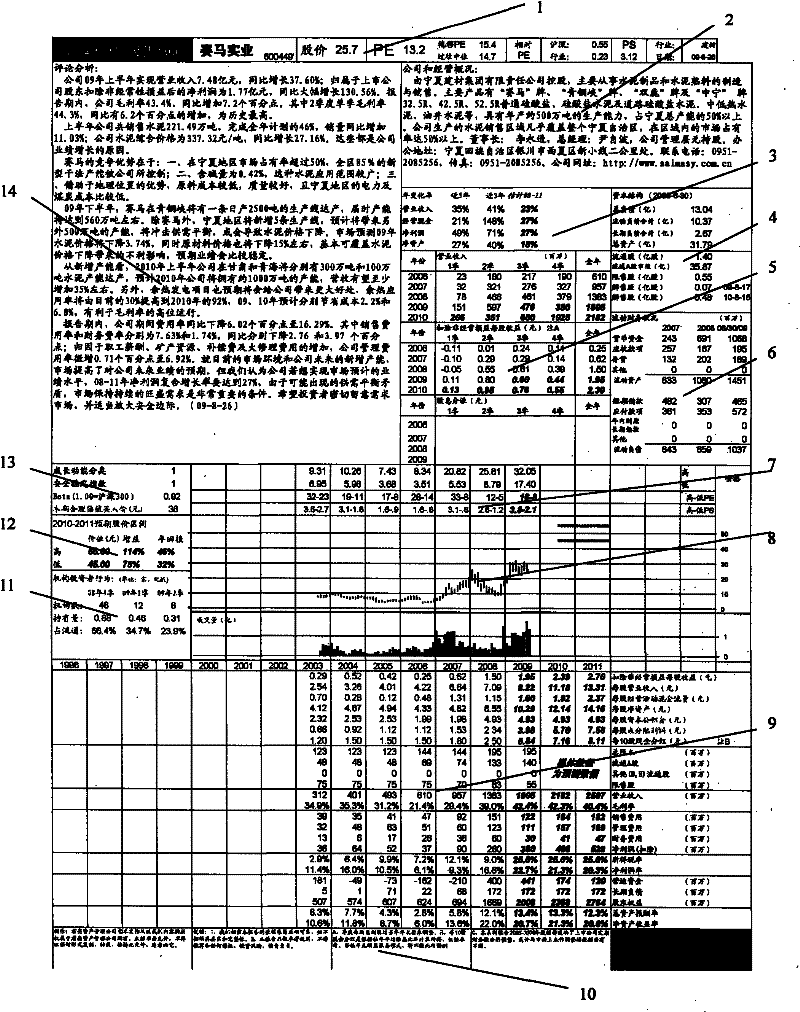

Stock valuation report generating system and stock valuation report template format

The invention belongs to the field of financial data analysis products, which belongs to stock valuation tools. In the present stock investment market, over-large related companies and stock markets have over-high quantity of information and a large amount of messy information, so that people are all in a jumble usually and do not know methods for solving problems. A solution is provided for the problems through a stock valuation report, and the report comprises the following step that: the most important financial data index and related information of a quoted company, and a valuation system are collected in a most saving and efficient format space which is specially manufactured to manufacture a simplest stock valuation tool, so that an investor can see the valuation system within an extremely short time and find the current investment direction. A stock valuation report generating system is a process of manufacturing the stock valuation report, and the stock valuation report in a special format is mainly manufactured by utilizing a computer software program developed by Shenzhen Junliang Asset Management Limited Liability Company.

Owner:SHENZHEN JUNLIANG ASSET MANAGEMENT

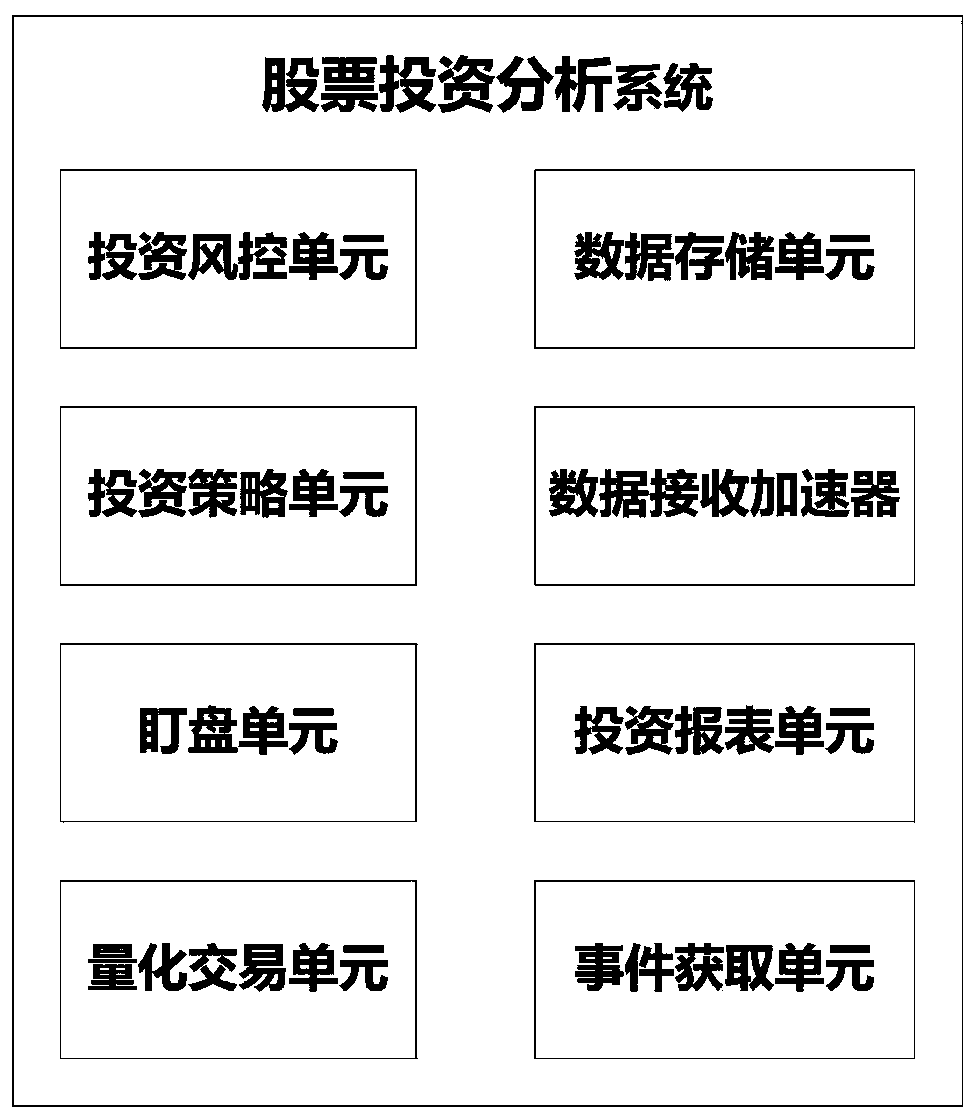

Artificial intelligence stock investment analysis system

PendingCN110163758AThe transaction is validEfficient analysisDigital data information retrievalFinanceRisk ControlStaring

The invention discloses an artificial intelligence stock investment analysis system which comprises a data receiving accelerator, a data storage unit, an investment strategy unit, an investment risk control unit, a quantitative transaction unit, a staring-in unit and an investment report unit. The data receiving accelerator is used for quickly acquiring the price and transaction data of the securities; the data storage unit is used for storing relevant data of securities; the investment strategy unit is used for setting an investment strategy and a strategy implementation period by a user; theinvestment risk control unit is used for analyzing historical market conditions and financial information of investment products and financial information of issuers to obtain investment risks of theissuers or the investment products; the quantitative transaction unit is used for automatically carrying out quantitative transaction according to an investment strategy of a user; the staring-in unit is used for acquiring and monitoring market change of securities in real time and giving an alarm according to a set threshold value; and the investment report unit generates an investment report according to the current stock and the transaction condition of the investment product.

Owner:苏州慧财智科技有限公司

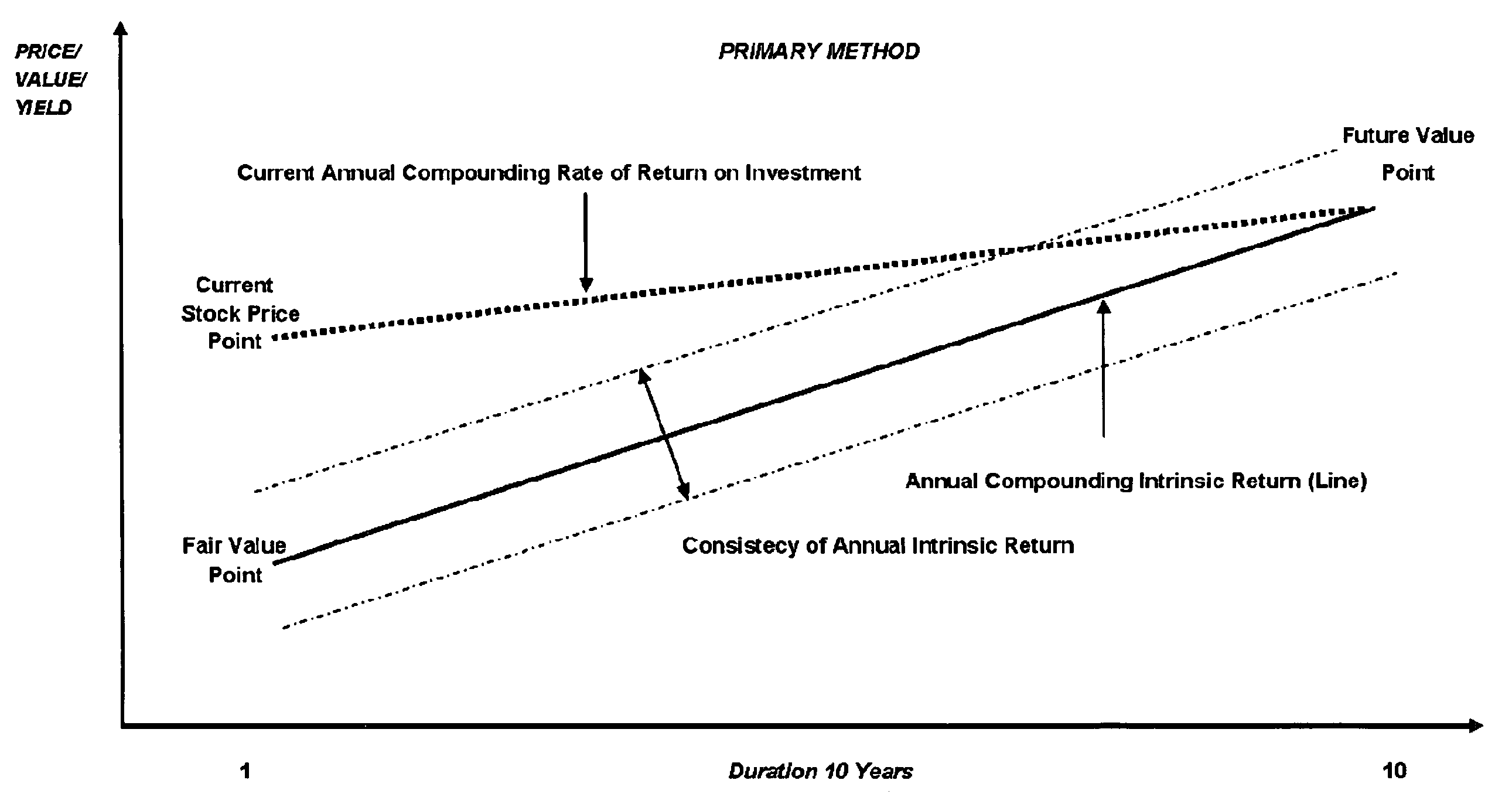

System and method for determining profitability of stock investments

InactiveUS20080154794A1Highly accurateHighly predictableFinanceComplex mathematical operationsEnvironmental geologyStock investment

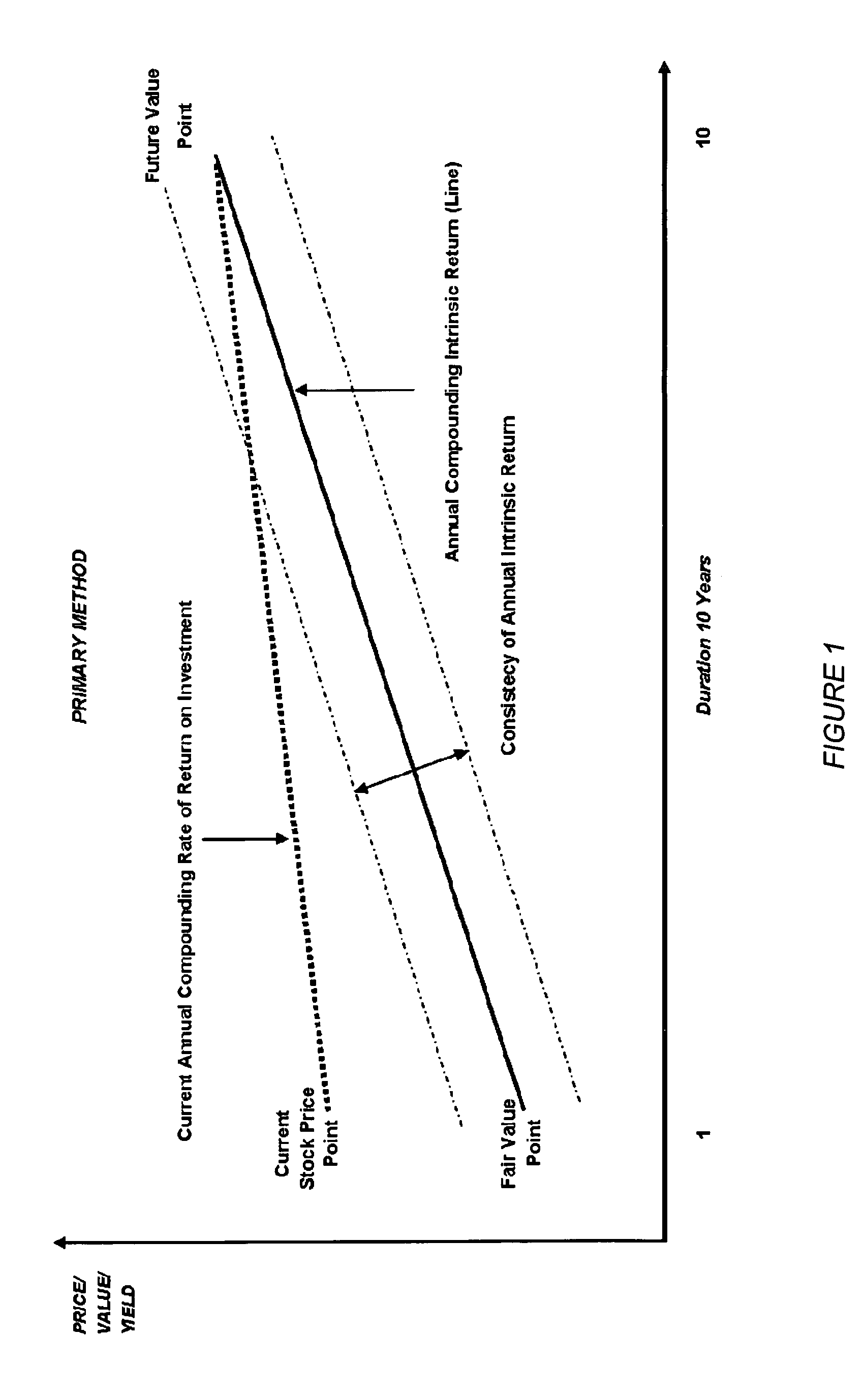

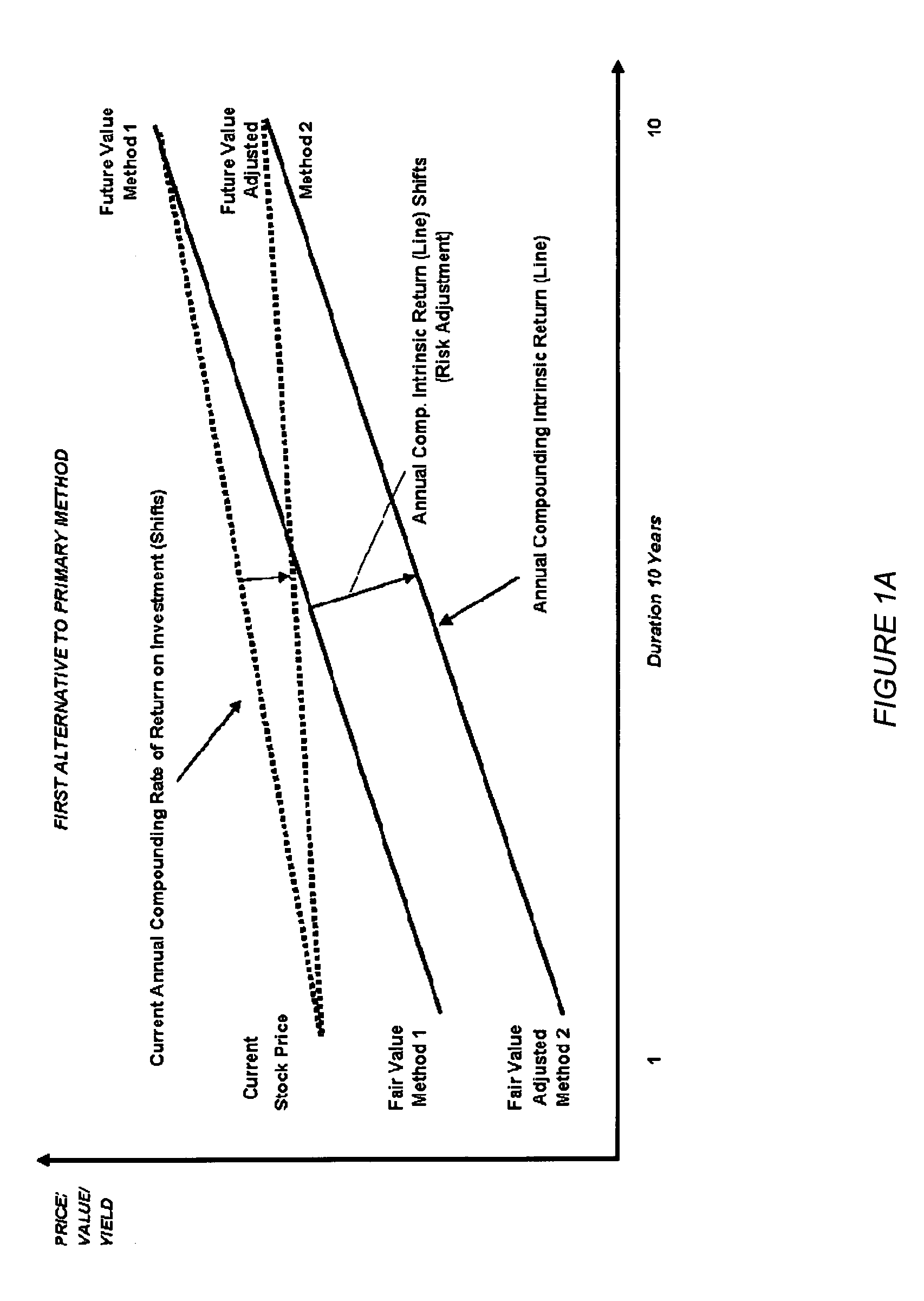

A system and method for determining profitability on stock investments. The method includes determining or calculating a fair value of a particular stock (which may further include taking into account risk), determining or calculating the annual compounding intrinsic growth of the company, determining or calculating the consistency of the intrinsic growth (such as risk); and generating the current annual compounding rate of return on investment.

Owner:JOHANSSON PETER J

System, report, and computer-readable medium for analyzing a stock portfolio

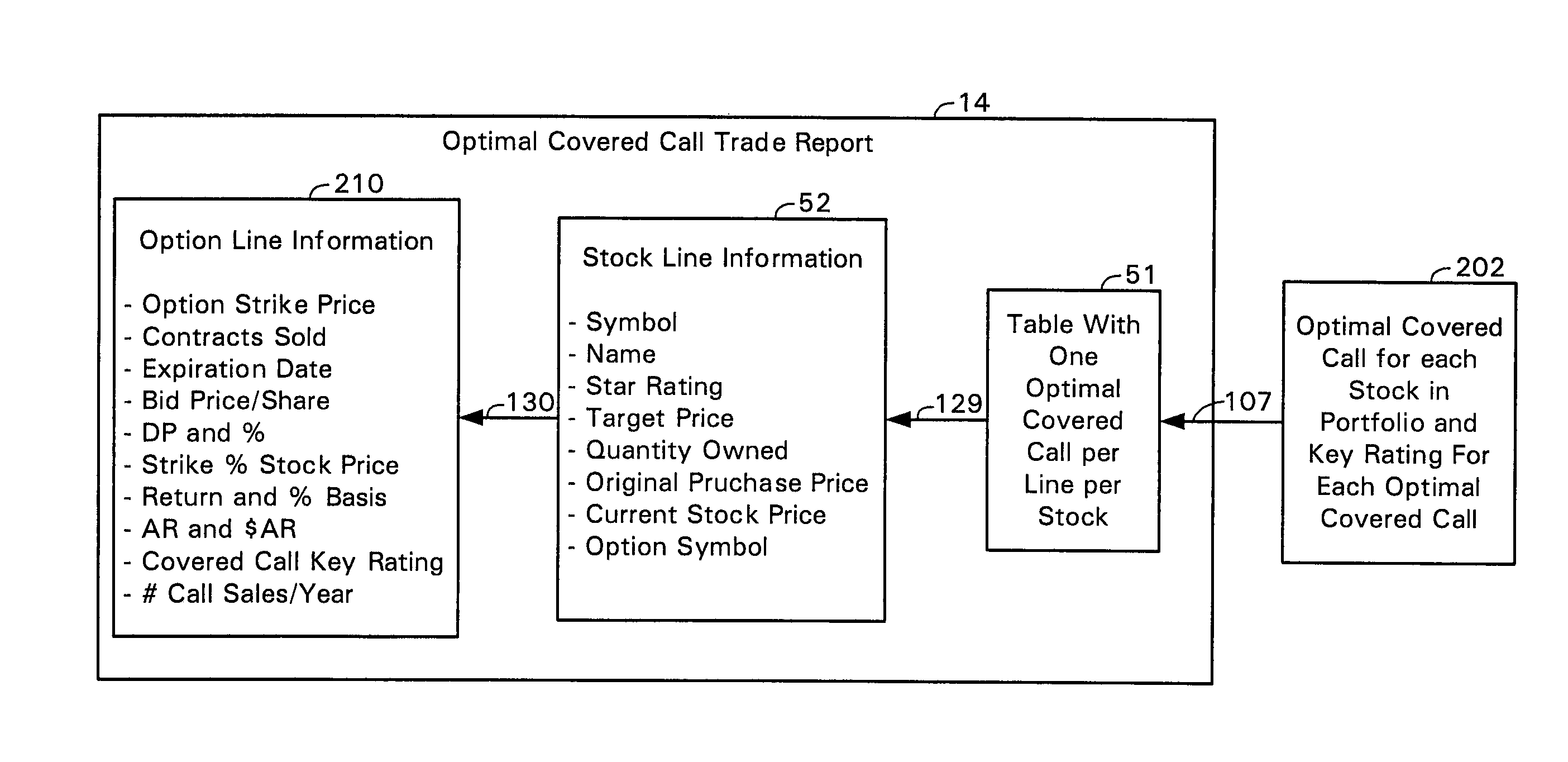

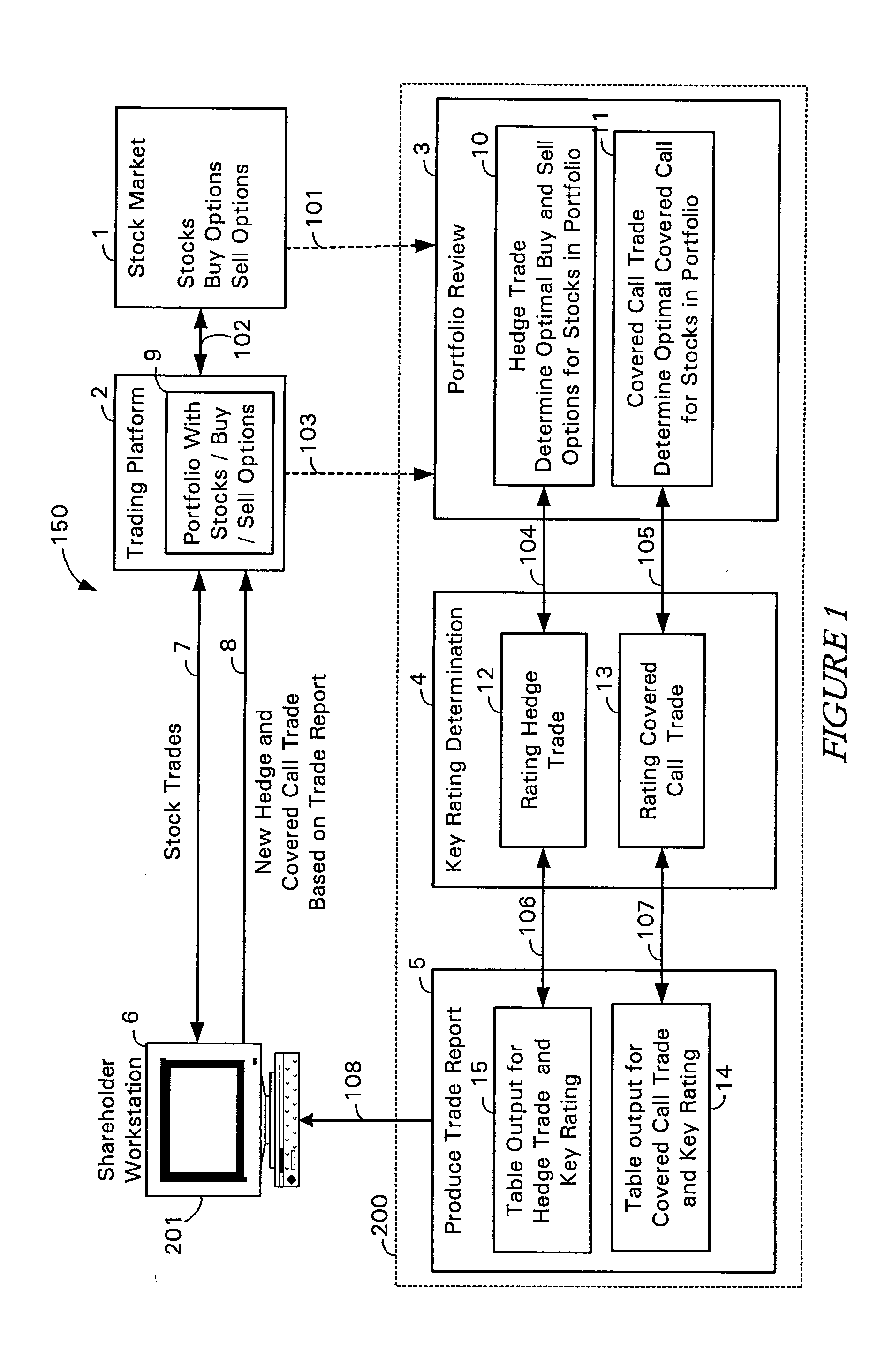

The present invention is directed to a stock portfolio analysis system able to determine an optimal covered call trade for each of a plurality of stocks within a stock investor's portfolio, determine an improved key rating factor associated with each optimal covered call trade, and produce a trade report that displays the optimal trades along with the key rating. In another embodiment of the present invention, the stock portfolio analysis system is able to determine an optimal hedge trade for each of a plurality of stocks within a stock investor's portfolio and provide the information along with a key rating determination in the form of a trade report. In yet another embodiment of the present invention, an income portfolio trade report is produced listing a covered call summary table, or alternatively, a hedge trade summary table, a table explanation section, and a financial summary where each covered call is associated with a key rating. In a further embodiment, the above-described embodiments of the present invention are implemented in a computer-readable medium where the report, information, analysis system are executed by a processor.

Owner:O2 MEDIA

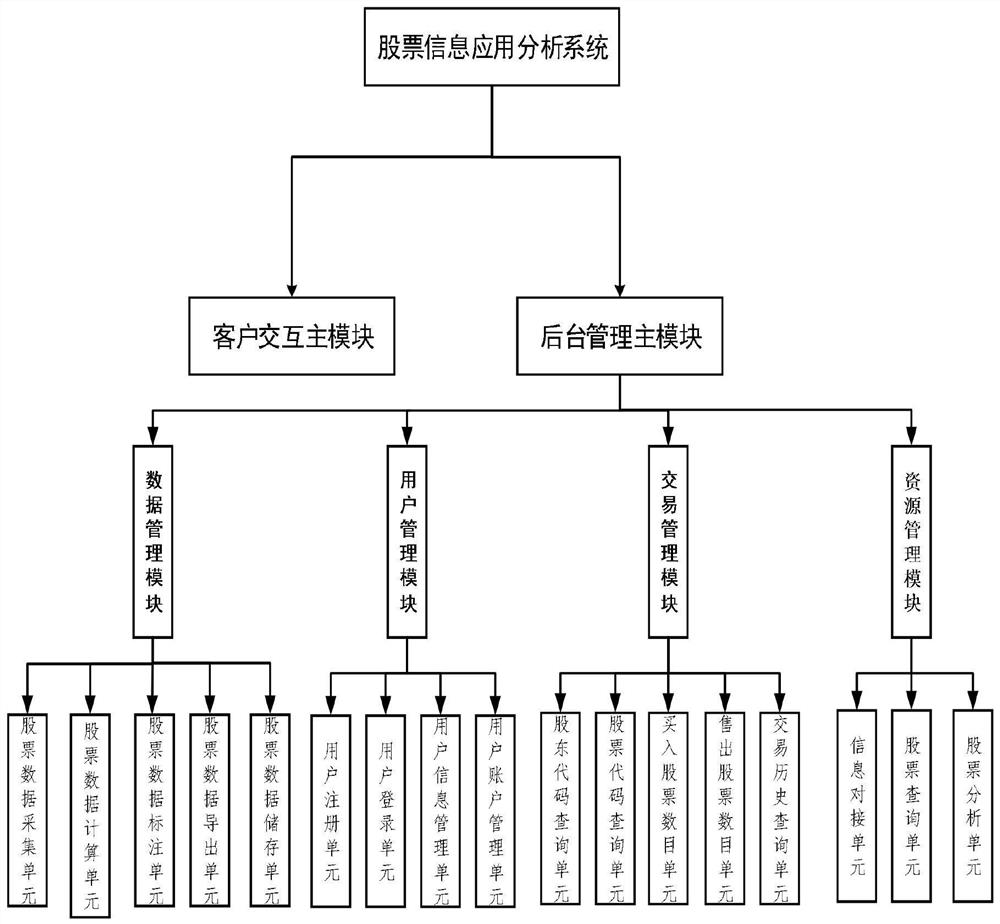

Stock information application analysis system

PendingCN111611487AIncrease profitabilityShort switching timeDigital data information retrievalFinanceEvaluation resultTransaction service

The invention discloses a stock information application analysis system. The method comprises a client interaction main module and a background management main module. The customer interaction main module is used for providing operations of user login, search, stock selection and collection; related plates and stock market information are displayed in an image-text or list form, and specific stockrelated information is displayed; meanwhile, the latest message is pushed according to the market change, and customer service is provided; the background management main module is used for executinguser management, authority management, stock management, customer service, statistical analysis service and stock transaction service. According to the invention, efficient, real-time and comprehensive aggregation of stock messages can be realized; users do not need to open various stock software or pages; each main information module for displaying the stock quotation can be quickly switched toby subscribing the stock in real time, so that the software switching time is reduced, the efficiency is improved, the system logicality is strong, the data is taken into consideration, the accuracy is high, the practicability is strong, and an evaluation result of practical help can be brought to stock investment.

Owner:上海腾韵信息科技有限公司

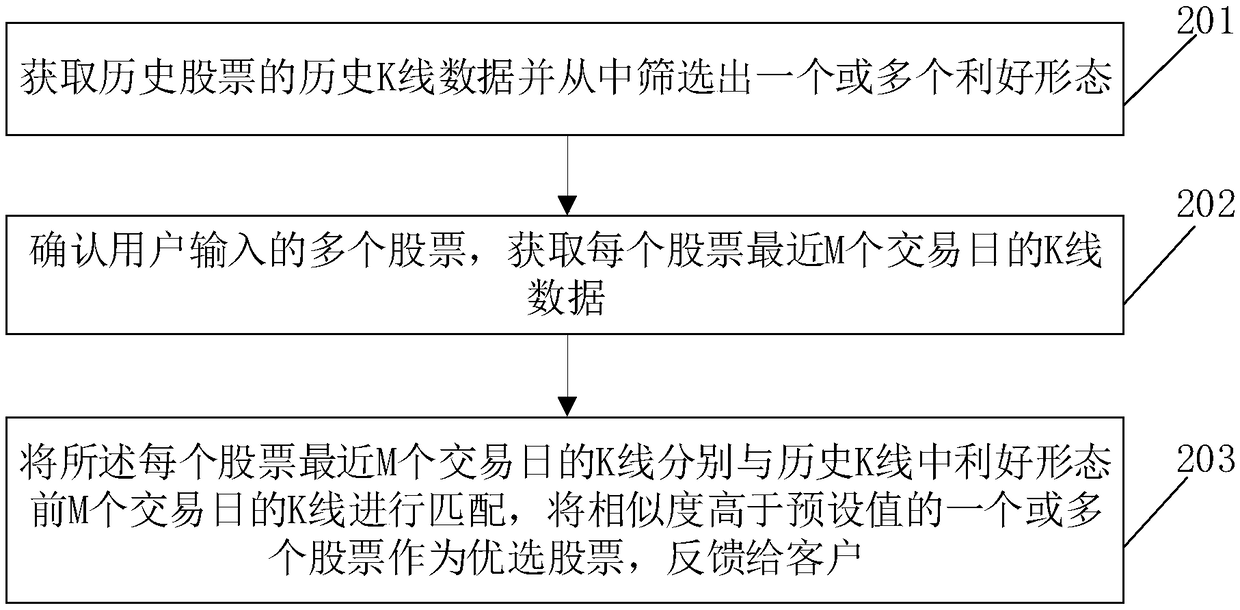

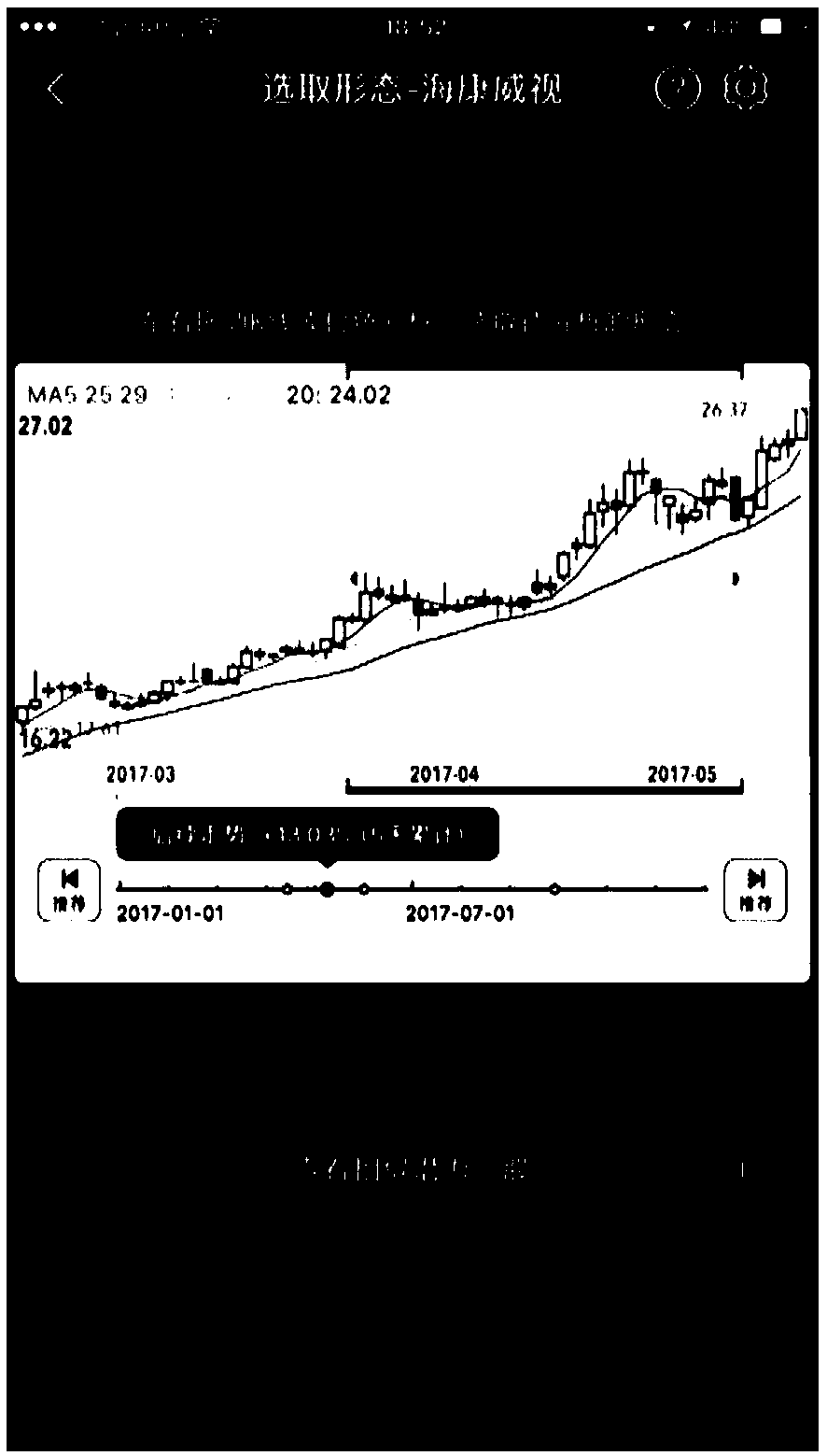

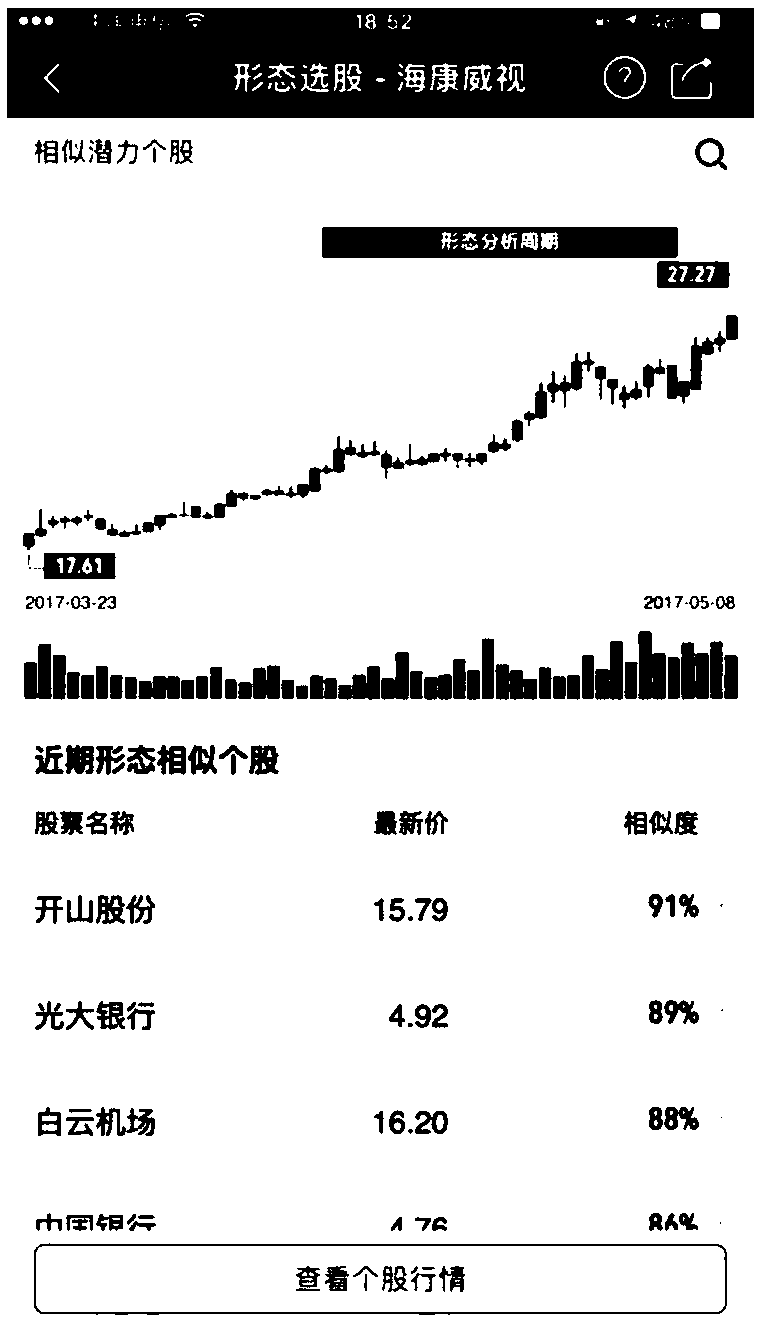

Method and device for selecting specific curve stocks according to existing curve forms

InactiveCN108765146AImprove accuracyIntuitive and effective acquisitionFinanceData miningComputer technology

The invention relates to the field of computer technology and provides a method and a device for selecting specific curve stocks according to existing curve forms. The method comprises the steps thathistorical K-line data of historical stocks is acquired, and bull forms are screened from the historical K-line data; multiple stocks input by a user are confirmed, and K-line data of each stock in recent M trading days is acquired; and K-lines of each stock in the recent M trading days are matched with K-lines with the bull forms in the first M trading days among historical K-lines, one or more stocks with similarities higher than a preset value are used as preferred stocks, and the preferred stocks are fed back to a client. Through the method and the device, according to the bull forms of the historical stocks, the stocks which most possibly have similar bull forms in the future are obtained through matching in recent stocks, an investor can visually and effectively acquire the stocks ina good future trend through a K-line graph, and a reference tool for stock investment is provided for the user; and meanwhile, stock curve similarity matching is performed from multiple dimensions, so that the matching result is more accurate.

Owner:武汉灯塔之光科技有限公司

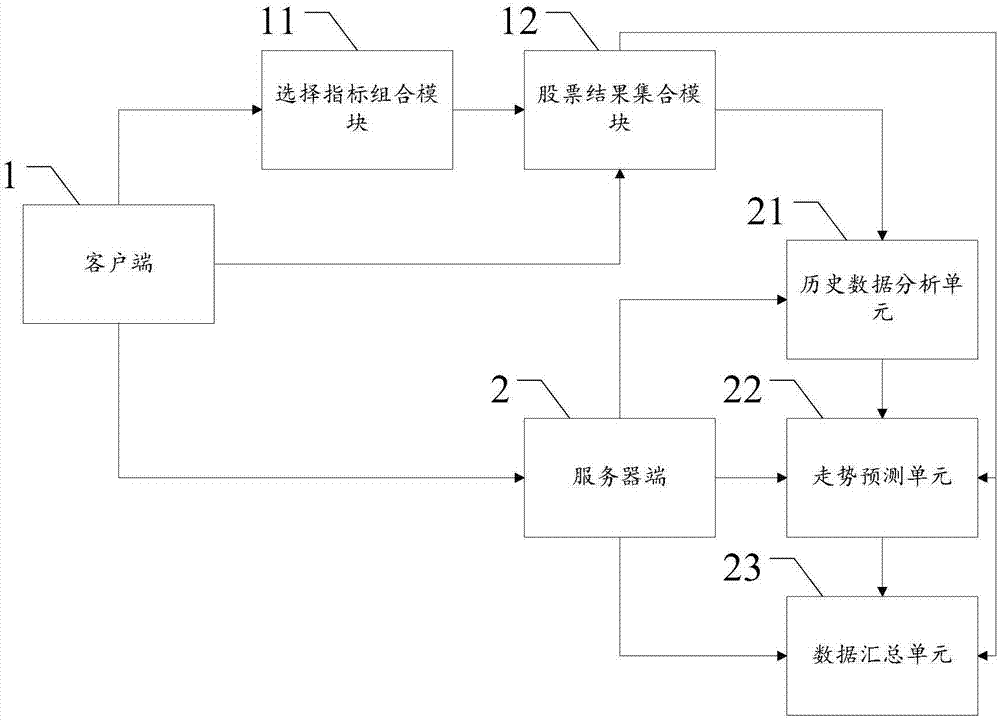

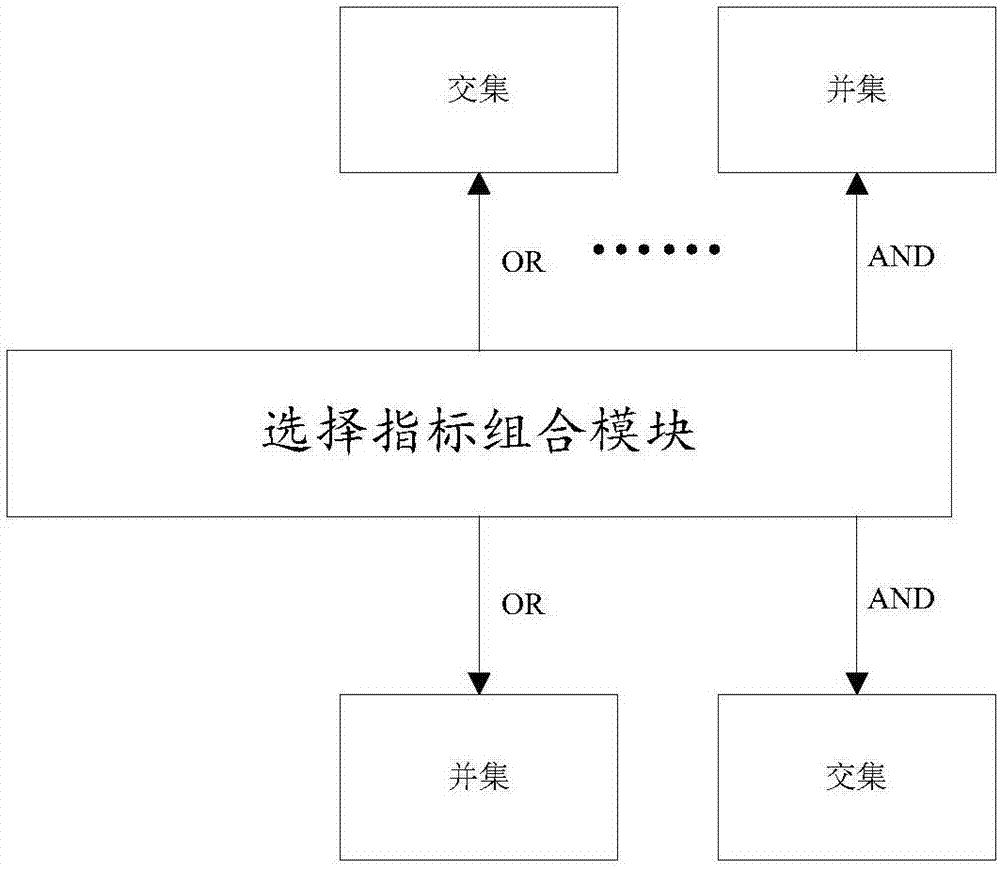

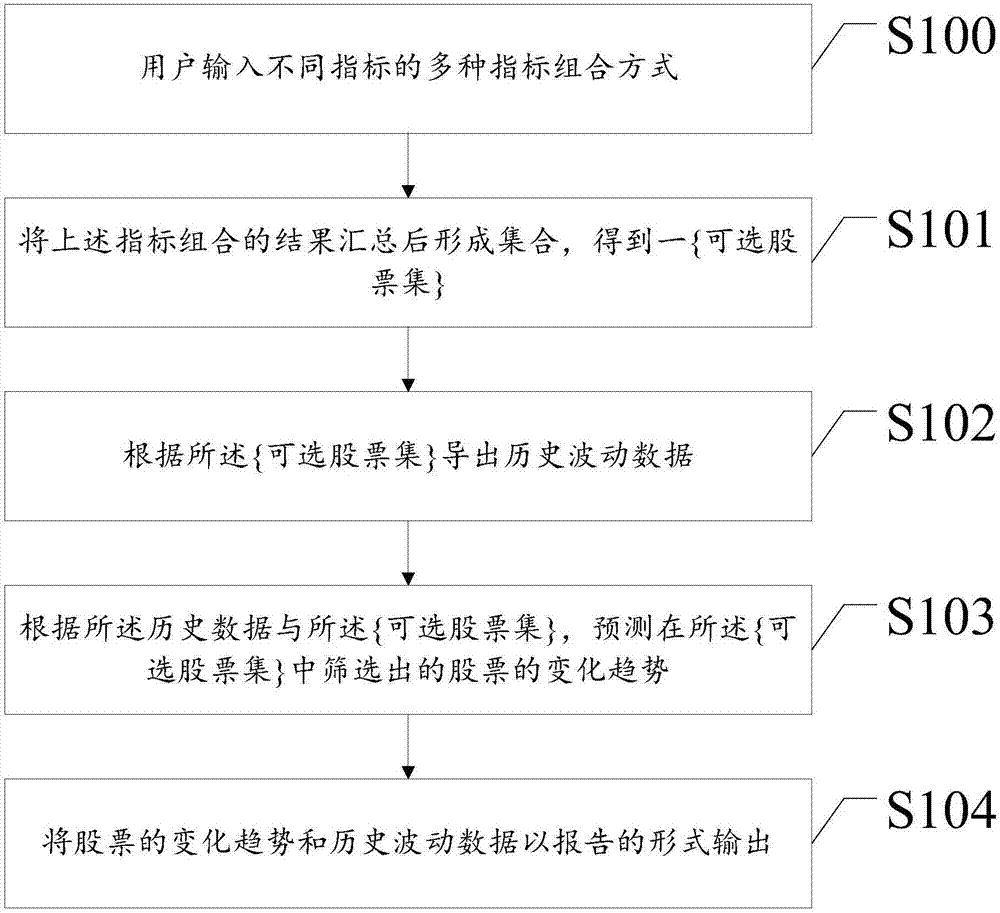

System and achieving method for investing stocks according to any index combination

The invention discloses a system and an implementation method for investing in stocks according to any combination of indicators. The system includes: a client and a server. The client includes: a selection index combination module and a stock result collection module. The server includes: The historical data analysis unit and trend prediction unit also include: a data summary unit. The present invention can realize arbitrary index combination to select suitable stocks, carry out multi-index combination based on the selected factors of each index surface, and select stocks according to the multi-index combination mode and display them to users. At the same time, users can choose technology that focuses on multiple indicators according to the dimensions they care about, so that they can combine multiple indicators to choose an appropriate investment plan.

Owner:武汉优品楚鼎科技有限公司

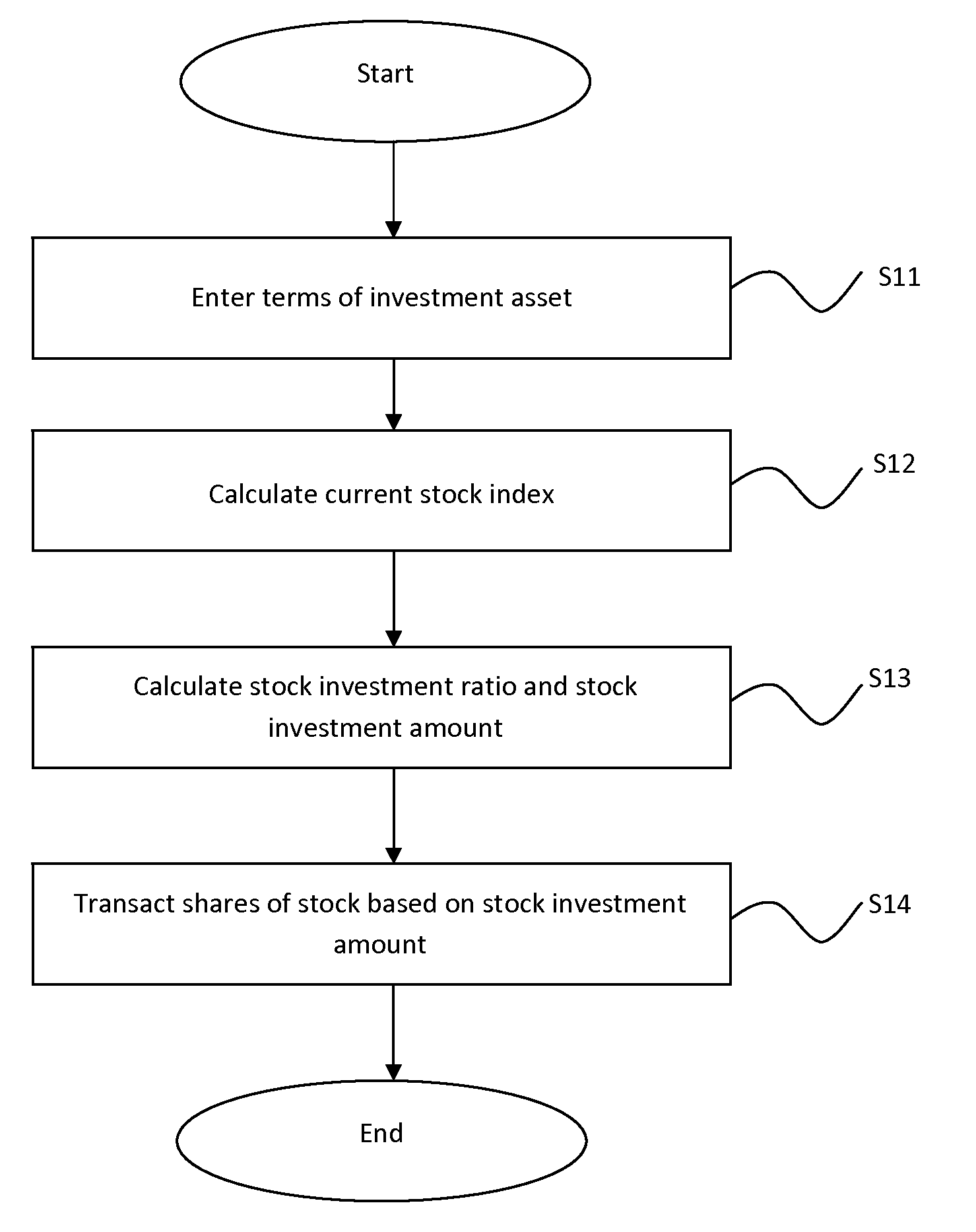

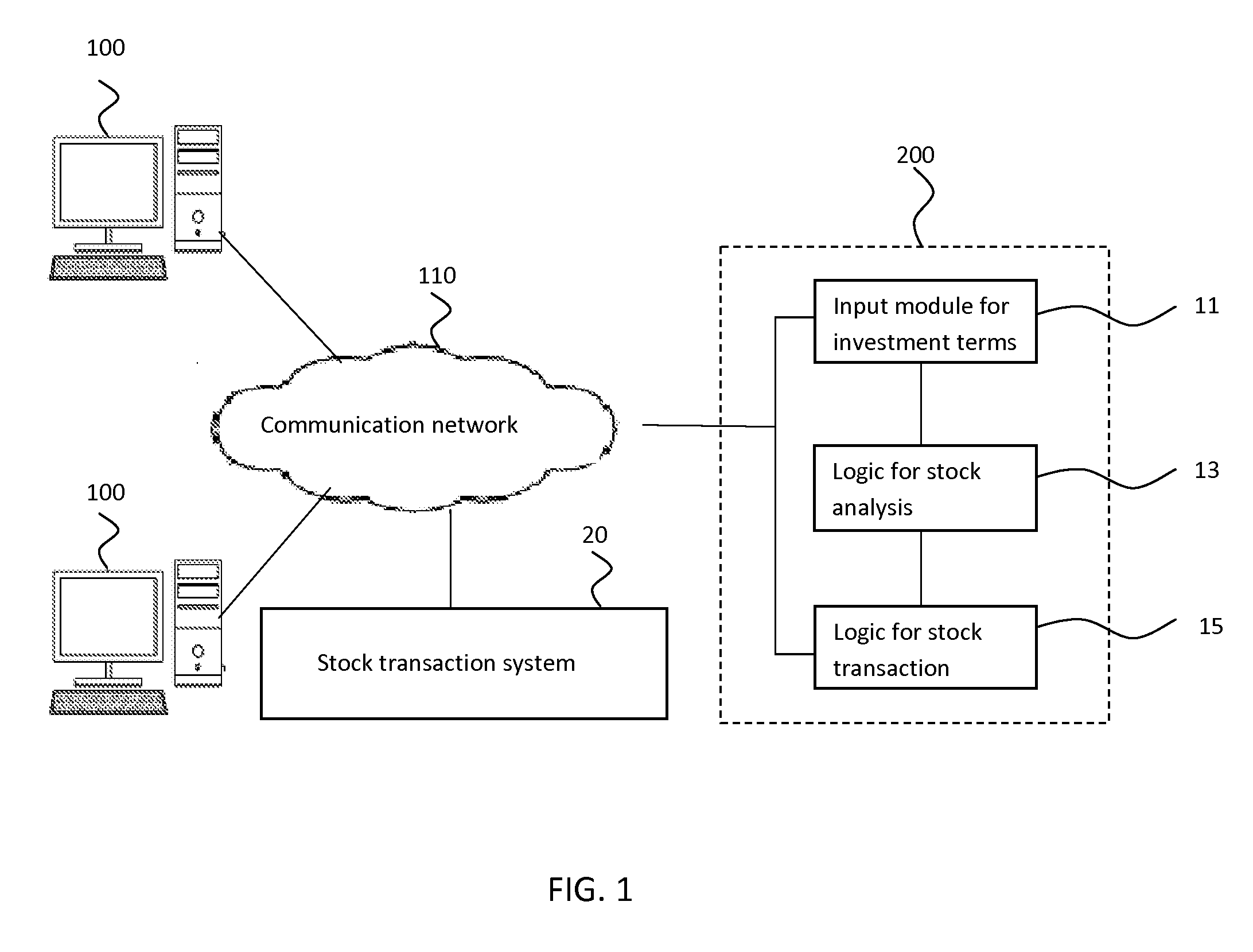

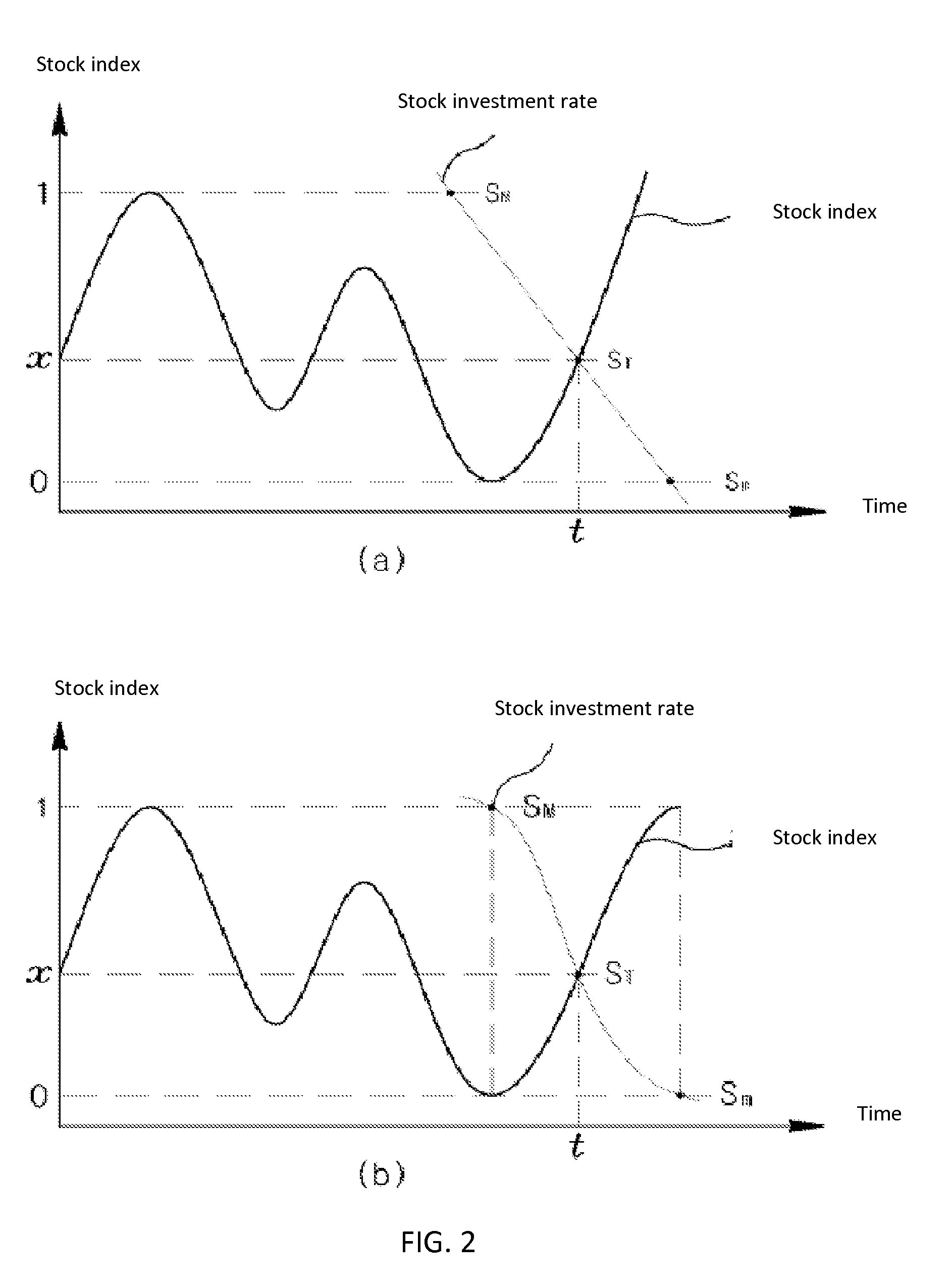

Financial asset management system

A financial asset / stock investment system and a method for performing necessary and optimal transactions periodically in response to fluctuating stock market. The system includes a data set of investment terms for clients, a stock analysis logic for calculating the stock investment amount and determining the stock investment ratio defined as the ratio of amount of stock to be held and transacted buying and / or selling stocks, and a stock optimal transaction logic for automatic buying and / or selling stocks recommended from investment terms, stock index, stock investment amount and transaction-buying and / or selling amount. The recommendation from the system is made to profit from stock trading based on the stock investment ratio.

Owner:LEE GYE YOUNG

Method and device for calculating information associated stock

PendingCN110889024ARapid positioningImprove investment efficiencyFinanceCharacter and pattern recognitionInformation processingUser needs

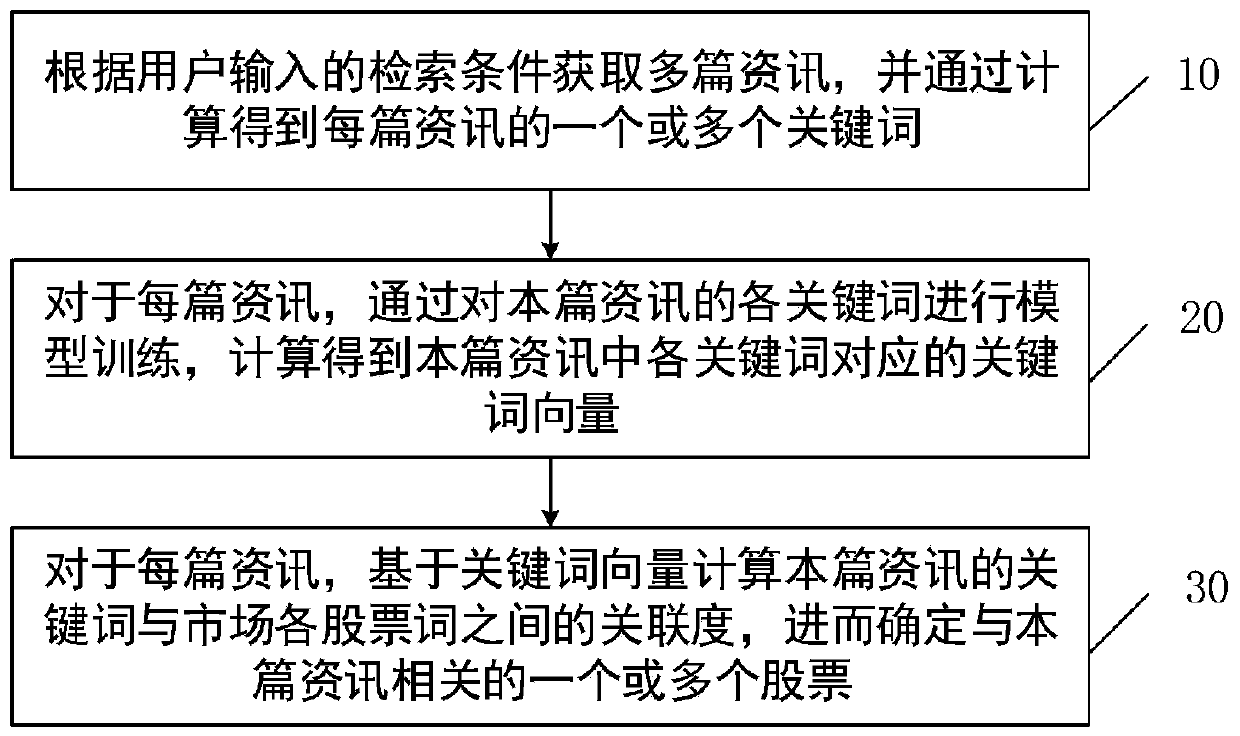

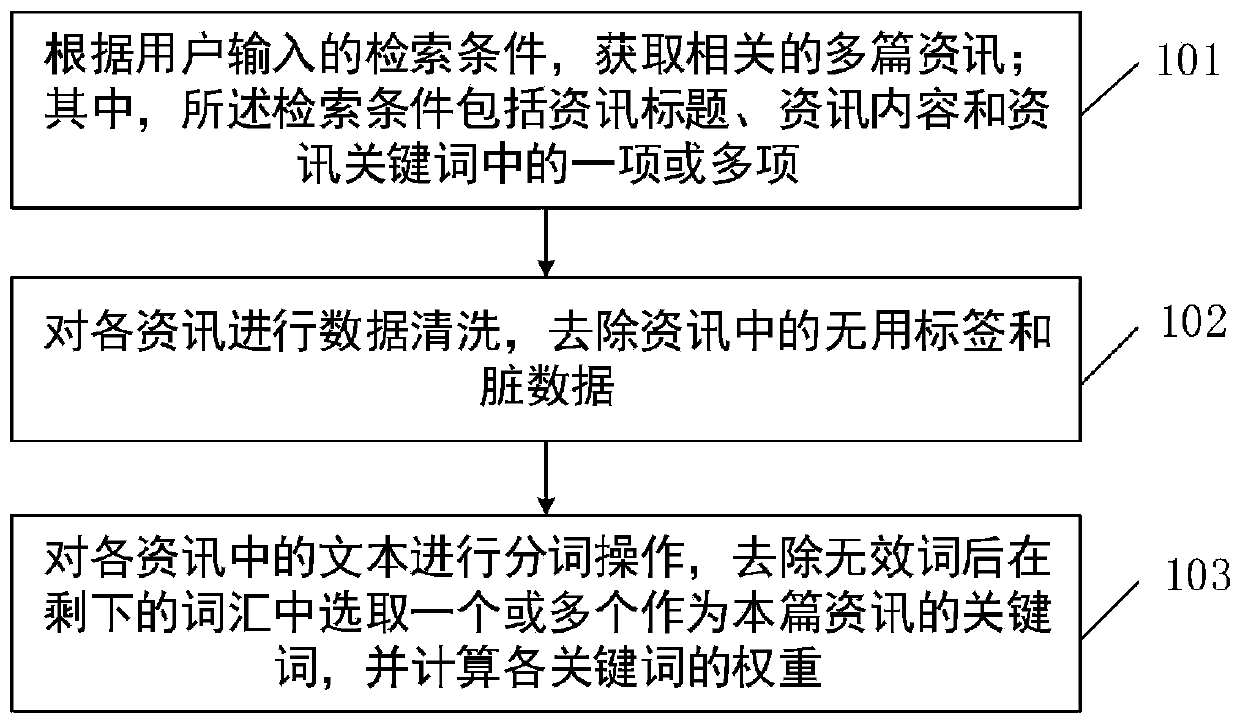

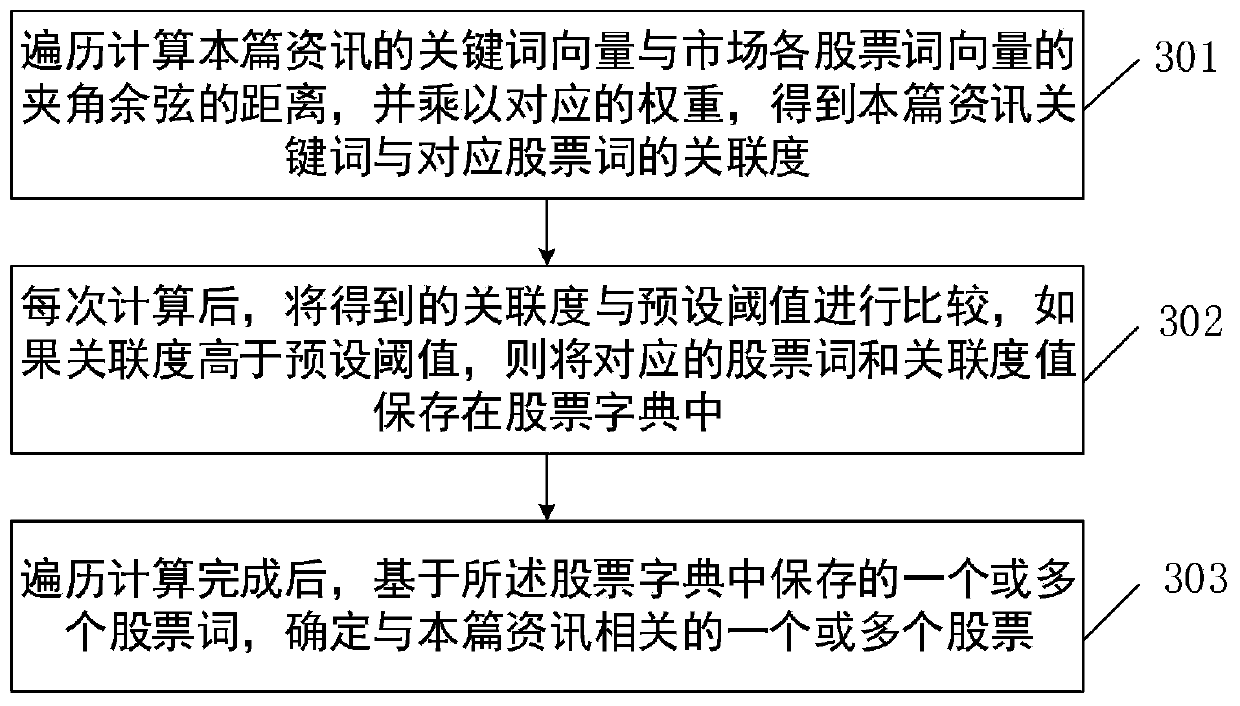

The invention belongs to the technical field of information processing, and particularly relates to a method and device for calculating an information associated stock, and the method comprises the steps: obtaining a plurality of pieces of information according to a retrieval condition inputted by a user, and obtaining one or more keywords of each piece of information through calculation; for eachpiece of information, performing model training on each keyword of the piece of information, and performing calculation to obtain a keyword vector corresponding to each keyword in the piece of information; and for each piece of information, calculating the association degree between the keyword of the piece of information and each stock word in the market based on the keyword vector, and furtherdetermining one or more stocks related to the piece of information. Mass information can be obtained according to user requirements, keywords of each piece of information are obtained through calculation, stocks associated with the information are obtained through rapid analysis and presented to users by calculating the similarity between the keywords and each stock word on the market, the users are assisted in stock investment transaction, and effective reference is provided for user investment.

Owner:武汉灯塔之光科技有限公司

Stock selection system for stock transaction

InactiveCN110942386ASolve the stock picking problemShorten the timeFinanceSelection systemData store

The invention discloses a stock selection system for stock transaction, and the system comprises a plurality of stock selection program units, and screens out a plurality of groups of screened stockscorresponding to the stock selection program units from all stocks of a stock market according to the corresponding specific screening criteria; an input unit which is used for inputting a plurality of calculation parameters to form investment preference indexes of investors; an investment preference database which is used for recording an investment preference index or an investment preference parameter group of the investor, and the investment preference parameter group comprises a plurality of investment preference parameters of a stock to which the investment preference parameter group belongs; an index selection unit for selecting an index to be calculated; and a data storage device which is used for storing stock market historical information data and real-time stock market information data; when the investor uses the input unit, and after preference indexes or investment preference options are input for the investment preference problem, the stock selection program unit calls the investment preference indexes or the investment preference parameter groups recorded in the stock investment preference database according to the information input by the investor, and automaticallycalculates at least one grade of stock suitable for the investor.

Owner:广东翼迅信息科技有限公司

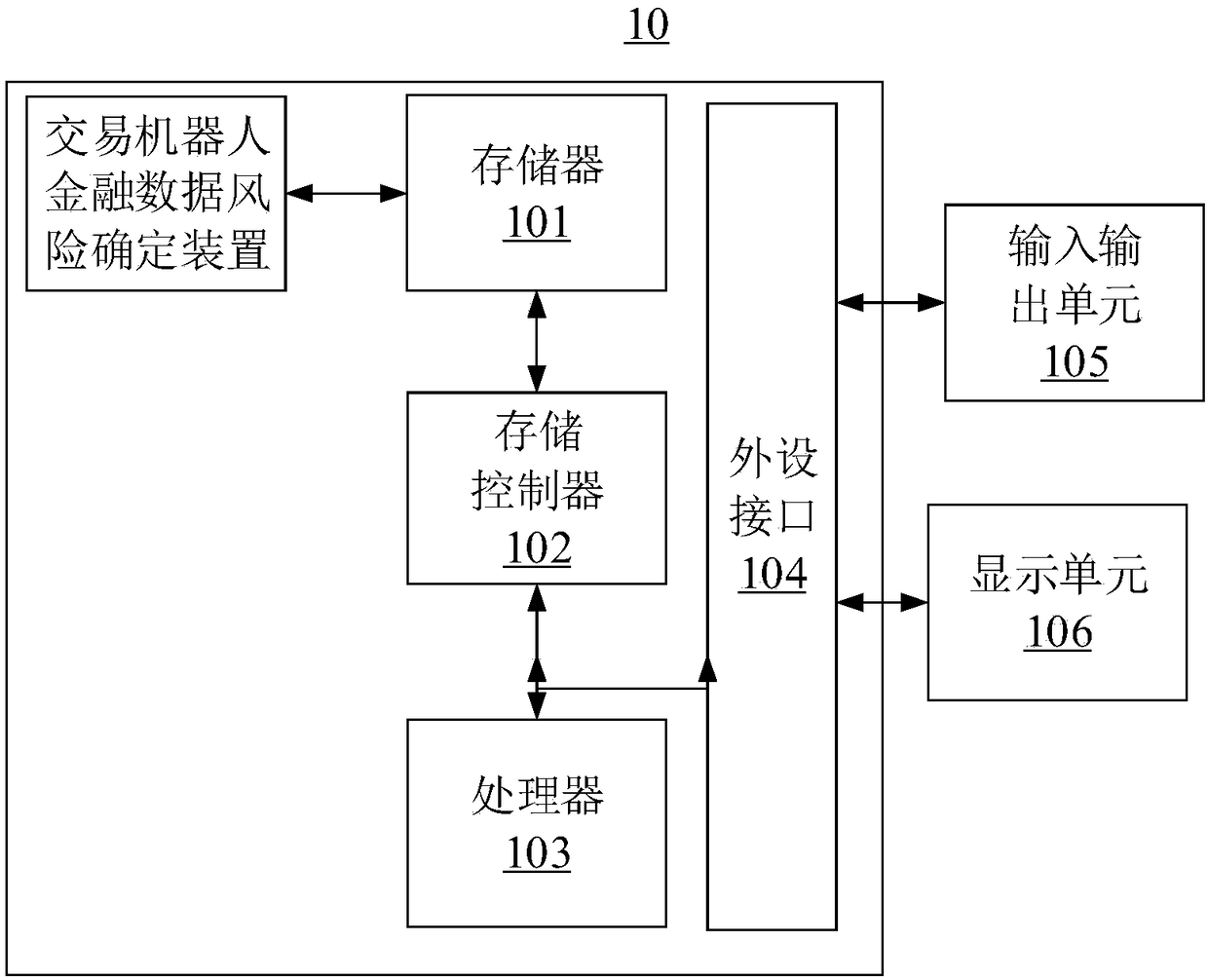

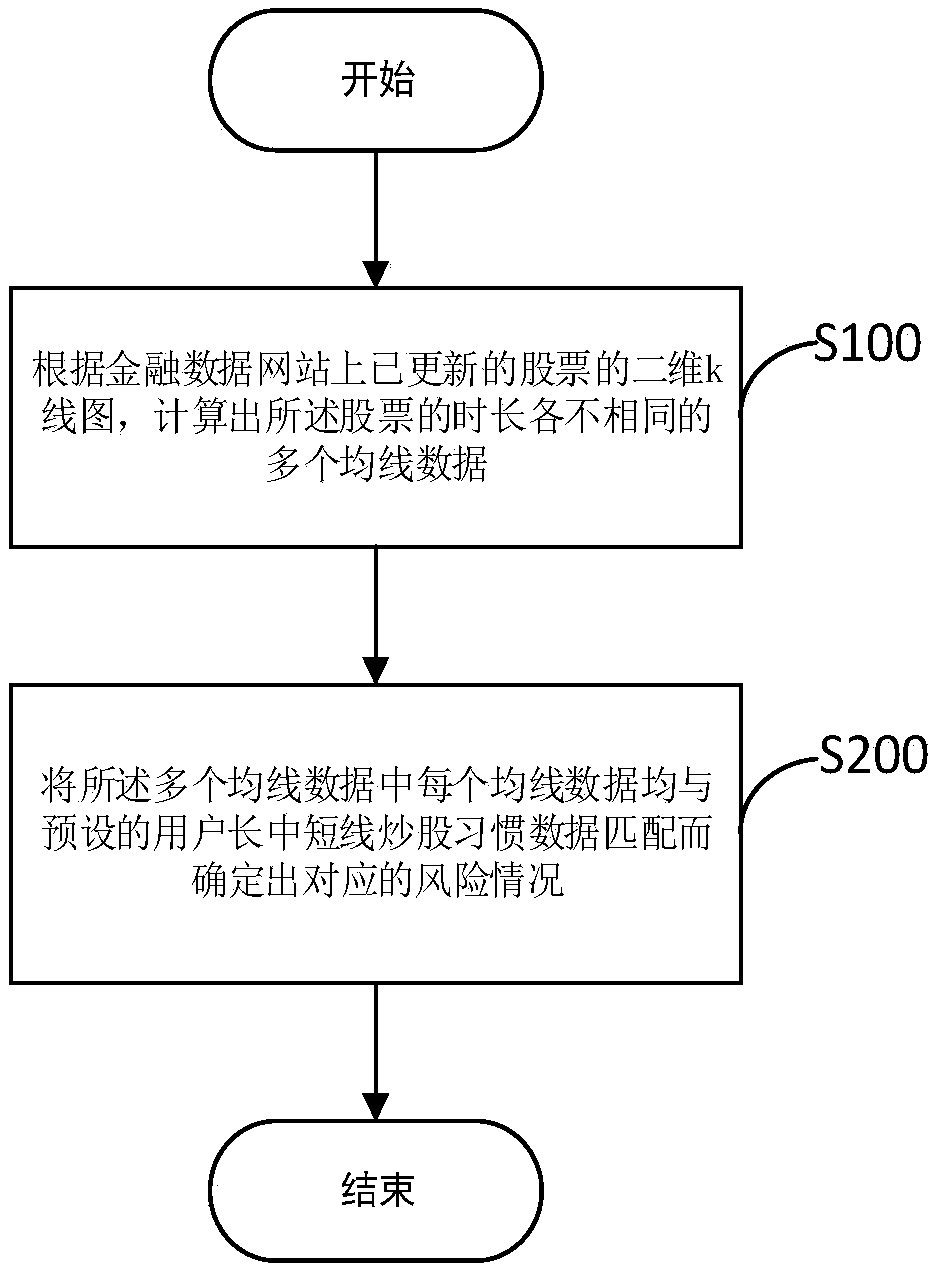

Transaction robot financial data risk determination method and device

Embodiments of the invention provide a transaction robot financial data risk determination method and device, and relates to the technical field of finance. The method comprises the following steps of: calculating a plurality of pieces of average data, time lengths of which are different, of a stock according to an updated two-dimensional k line chart of the stock on a financial data website; andmatching each piece of average data in the plurality of pieces of average data with preset user long / medium / short-line stock investment habit data so as to determine a corresponding risk condition. According to the updated two-dimensional k line chart of the stock on the financial data website, the plurality of pieces of average data, the time lengths of which are different, of the stock can be calculated, and each piece of average data in the plurality of pieces of average data is matched with the preset user long / medium / short-line stock investment habit data so as to determine the corresponding risk condition, so that users can conveniently and intuitionally know the risk condition corresponding to each holding time length of the stock, and then more correct reference basis is provided for the judgement of the users.

Owner:东莞市波动赢机器人科技有限公司

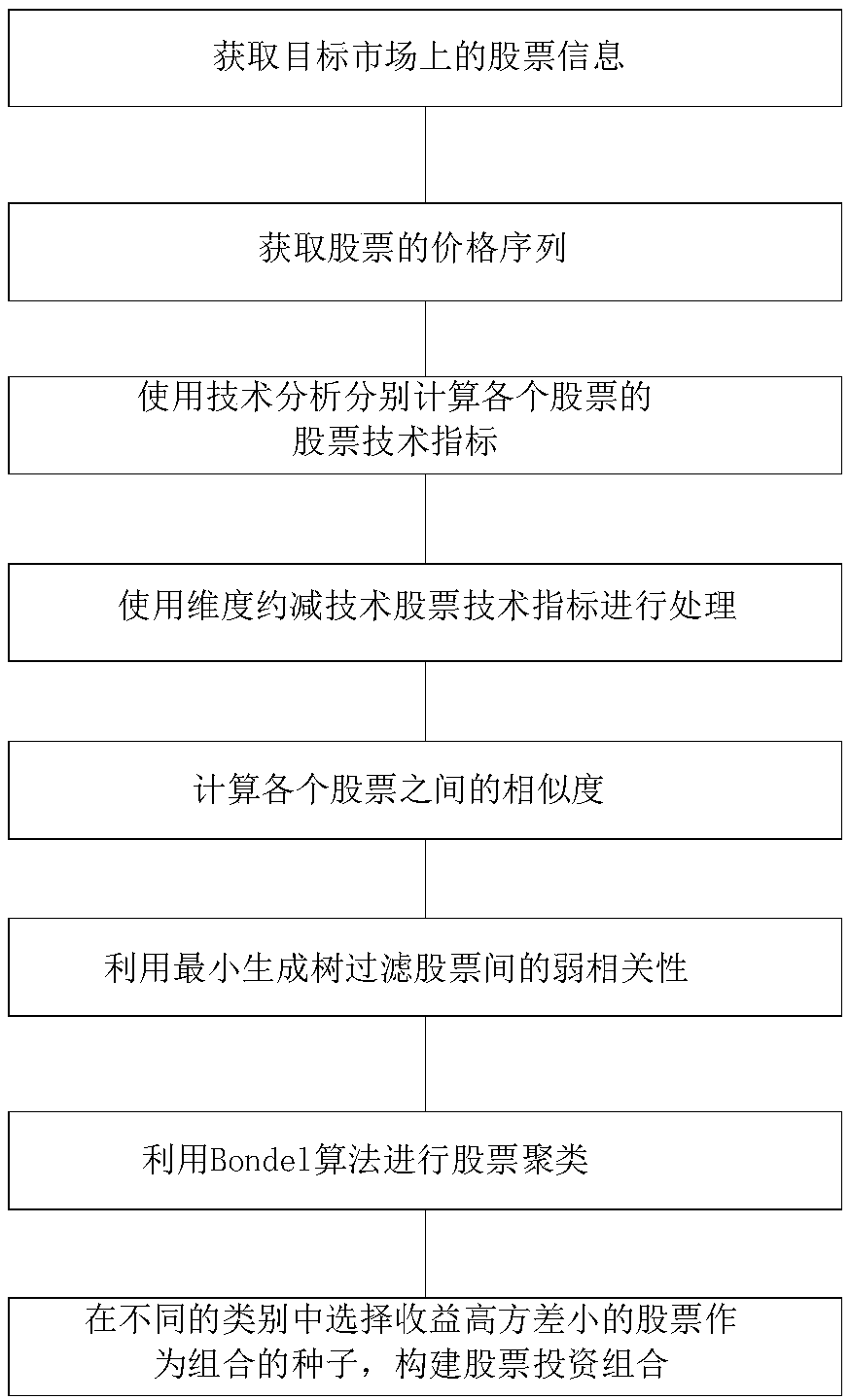

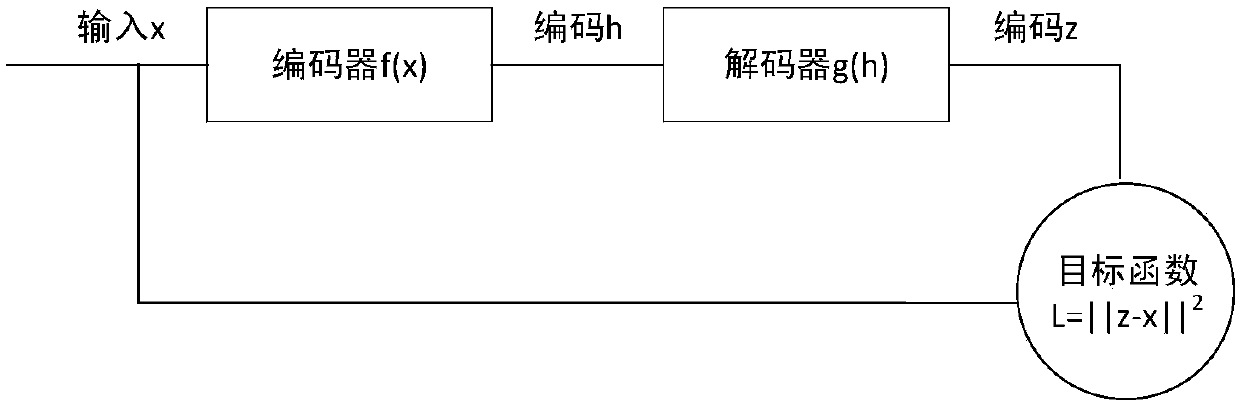

Investment portfolio method using dimensionality reduction

The invention discloses an investment portfolio method using dimension reduction. The method comprises the following steps: S1, obtaining stock information on a target security market; S2, obtaining aprice sequence of the stock; S3, using technical analysis to respectively calculate stock technical indexes of each stock; S4, performing dimensionality reduction on the stock technical index by using a dimensionality reduction technology; S5, calculating the similarity among the stocks according to the stock technical indexes of the stocks subjected to dimension reduction; S6, filtering weak correlation among the stocks by using the minimum spanning tree; S7, carrying out stock clustering by utilizing a Bond algorithm; and S8, selecting stocks with high earnings and small variance from different categories as seeds of the combination, and constructing a stock investment combination. By utilizing the method, the non-systematic risk of combination can be effectively reduced.

Owner:SHANGHAI UNIVERSITY OF FINANCE AND ECONOMICS

Shareholder service system for stock market information

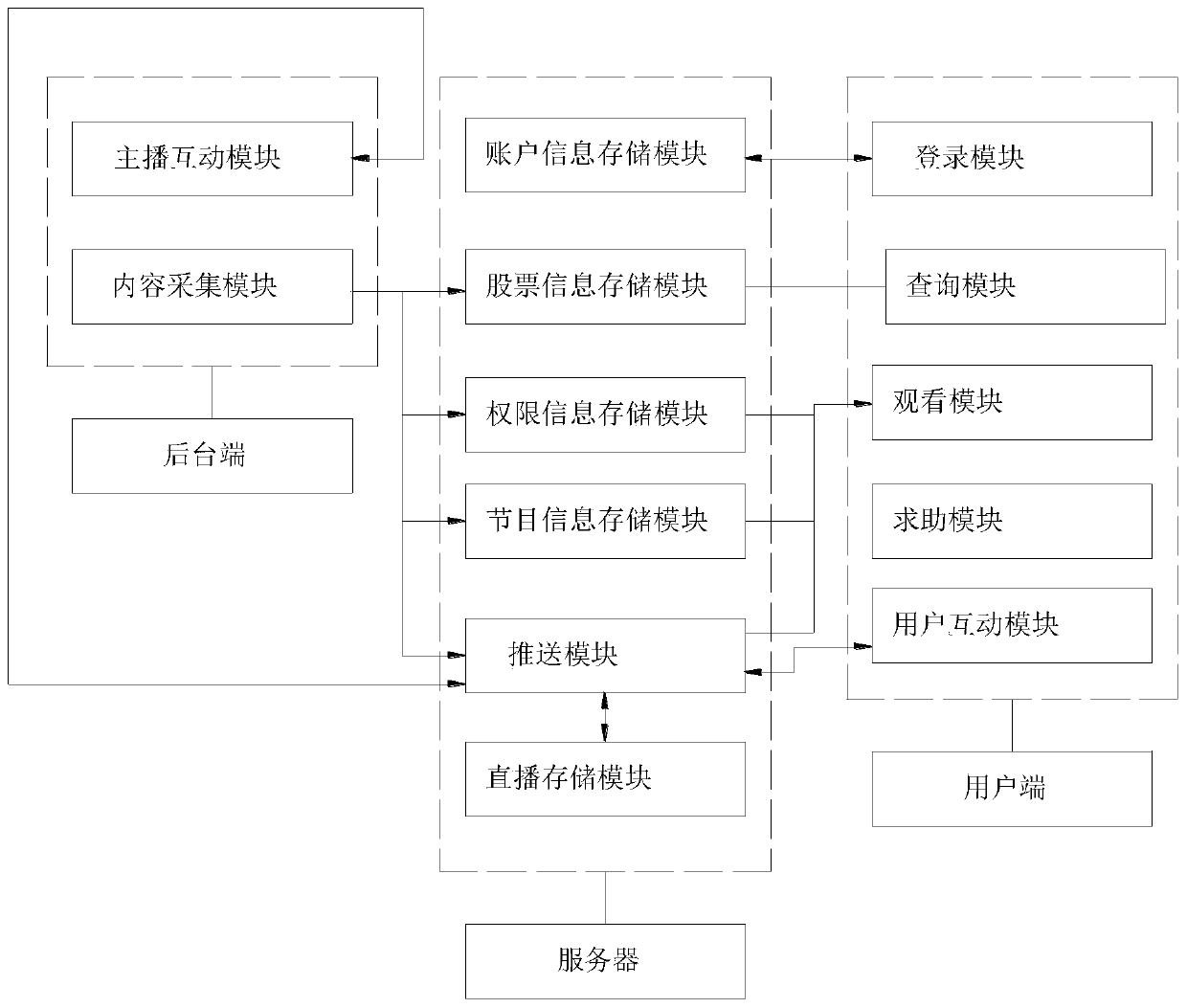

The invention is applicable to the technical field of information service, and provides a shareholder service system for stock market information. The shareholder service system comprises a server, abackground end and a user end, the background end comprises a content acquisition module and an anchor interaction module; the server comprises a pushing module, a stock information storage module, anaccount information storage module and a live broadcast storage module. The pushing module is used for receiving the live broadcast information and pushing the live broadcast information to the userside and receiving the anchor interaction information and pushing the anchor interaction information to the user side; the user side comprises a login module, a watching module, a query module and a user interaction module. A server, a background end and a user end are arranged; and the user can log in the user side through the login module to obtain live broadcast and video contents provided by the background side, and can inquire various stock information stored in the stock information storage module of the server, so that the user can obtain required information more fully and conveniently, and effective help is provided for subsequent stock investment of the user.

Owner:上海点掌文化科技股份有限公司

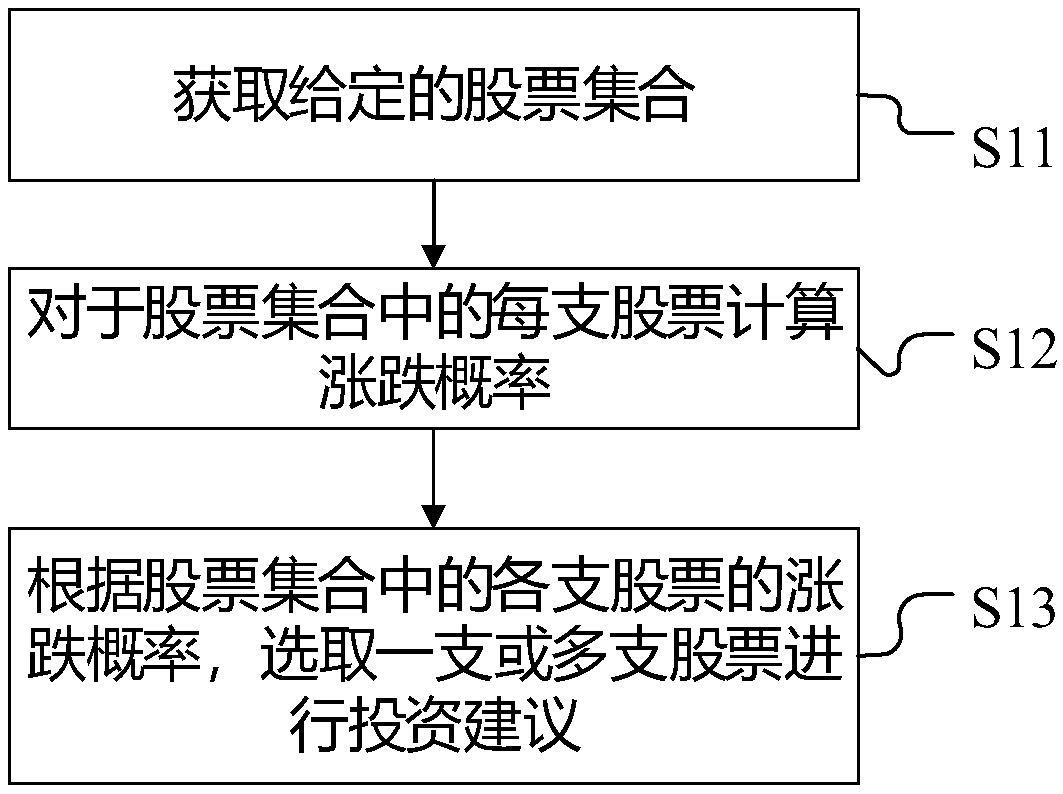

Method and apparatus for implementing stock investment recommendation

PendingCN109300030AImprove accuracyFinanceCharacter and pattern recognitionData miningStock dynamics

The invention discloses a method and apparatus for implementing stock investment recommendation. The invention includes acquiring a given stock set, calculating a rise and fall probability for each stock in the stock set; according to the fluctuation probability of each stock in the stock set, one or more stocks are selected to make investment suggestions, which is convenient, quick and accurate,and can help investors to understand the market trend and stock dynamics more accurately for investors or stock market analysts to use.

Owner:BEIJING QIHOO TECH CO LTD

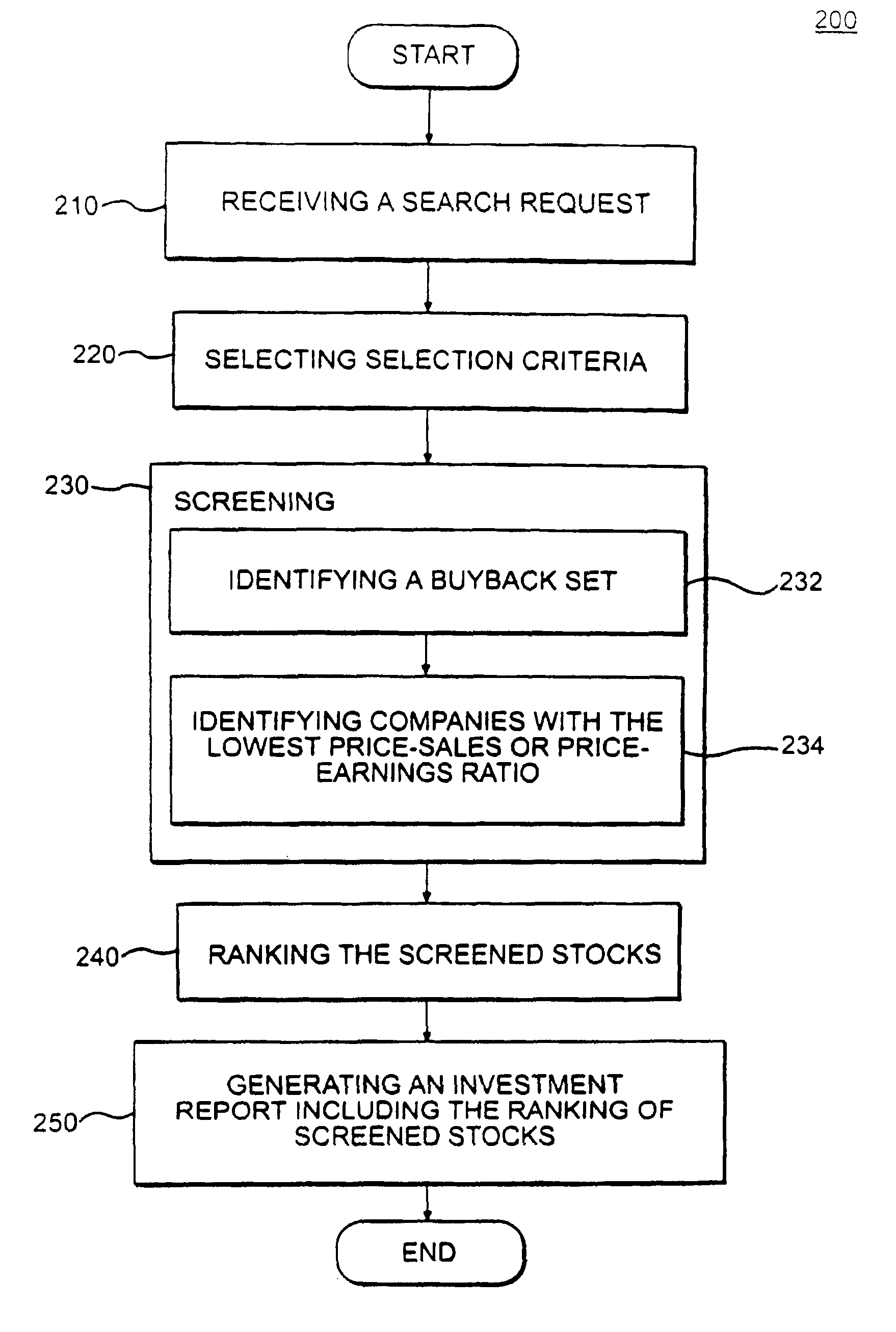

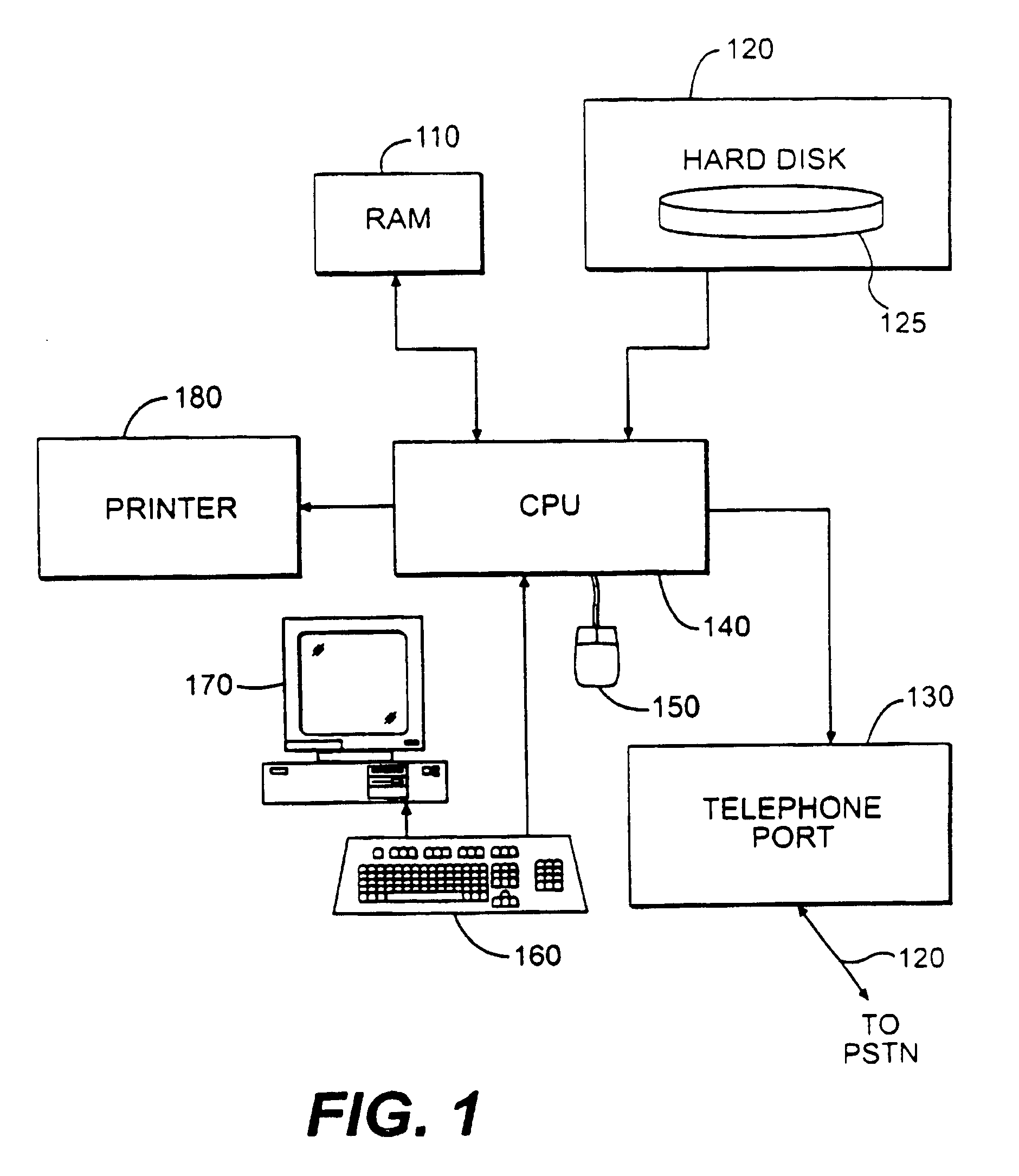

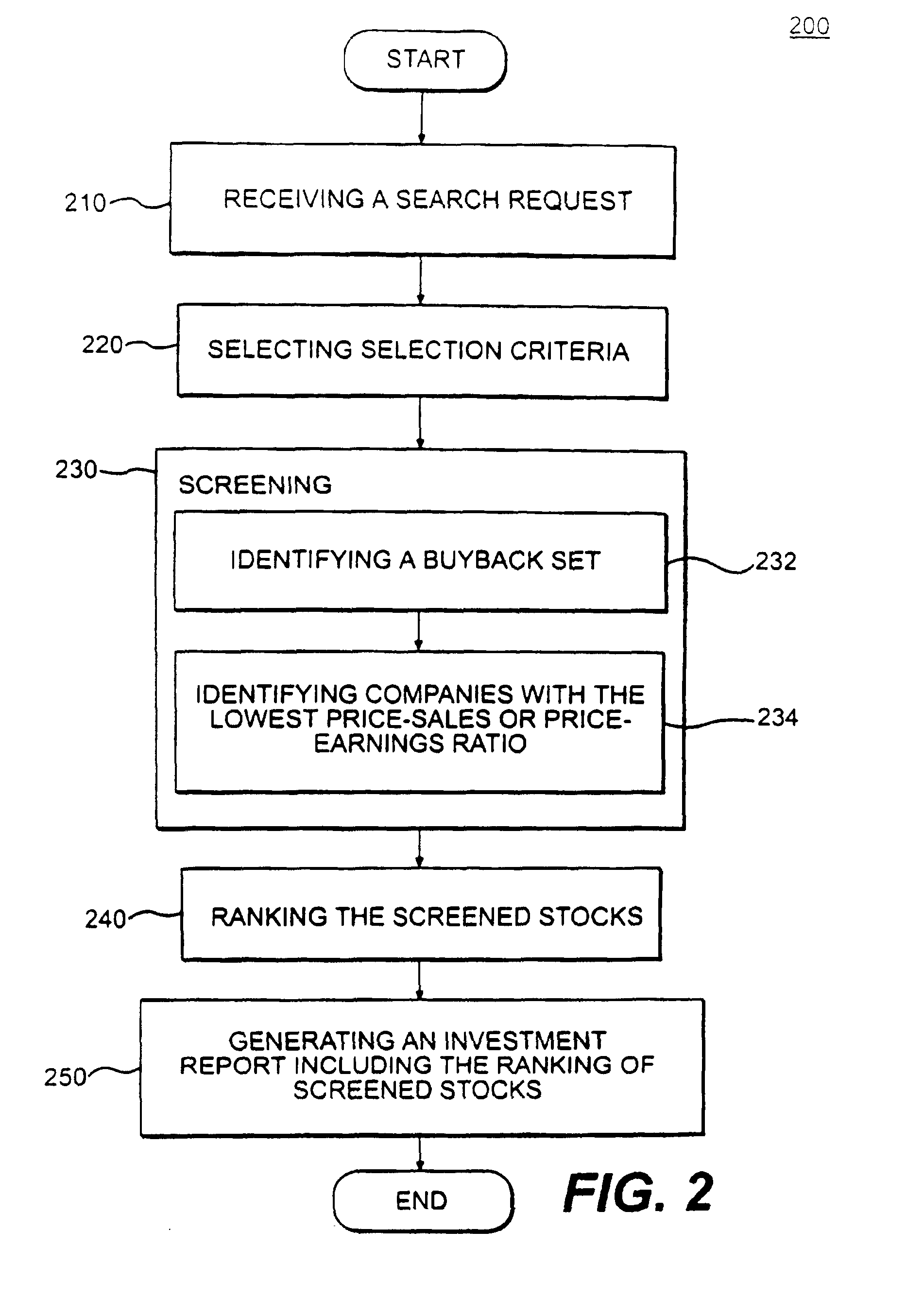

Computerized system and method for creating a buyback stock investment report

A computer implemented method for creating an investment report. A database of stock information is screened based upon buyback ratio and prices / sales ratio selection criteria. The buyback ratio represents the percentage of stocks repurchased by a company during a given period that resulted in a net decrease in outstanding shares. The method and system use the criteria to identify companies with a highest buyback ratio and with the lowest price / sale ratio. The resulting list of stocks are ranked and output in an investment report that provides superior return over conventional investment techniques.

Owner:FRIED DAVID R

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com