Computerized system and method for creating a buyback stock investment report

a technology of investment report and computerized system, which is applied in the field of investment portfolio management, can solve the problems of not being able to combine the performance of price/sales ratio and buyback theory to maximize the performance of stock investment portfolio, and repurchasing stock,

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

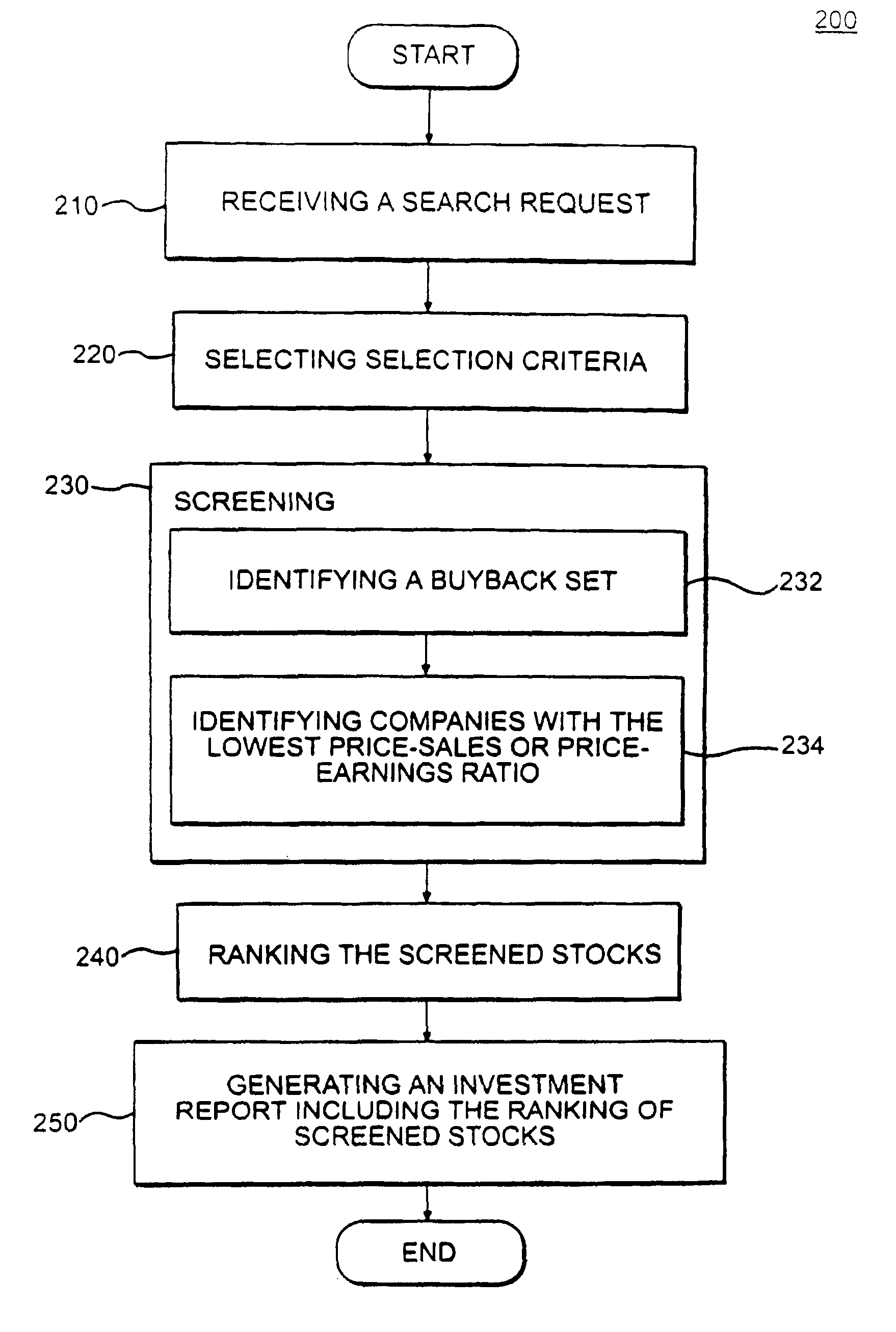

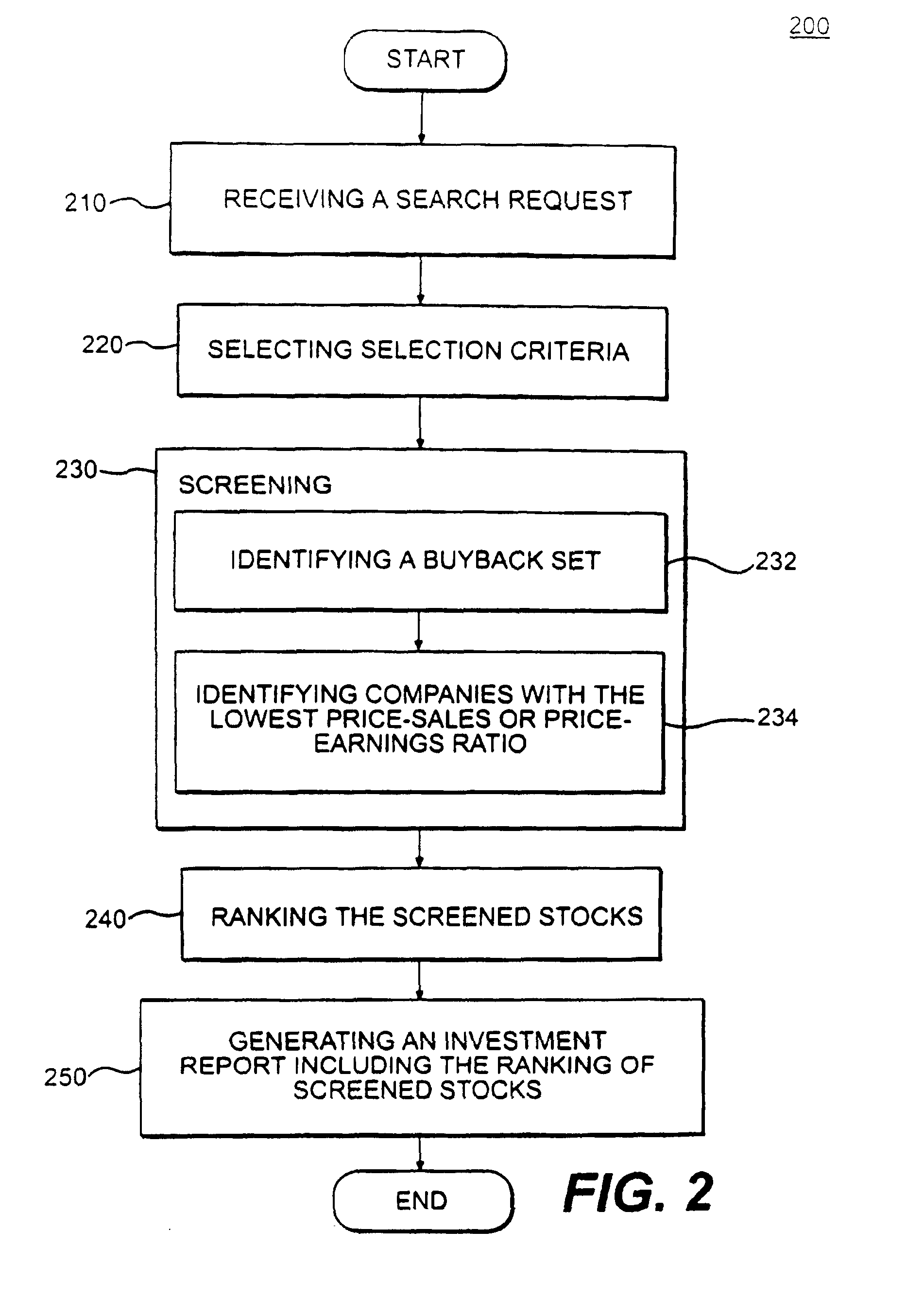

[0015]The following description of embodiment of this invention refers to the accompanying drawings. Where appropriate, the same reference numbers in different drawings refer to the same or similar elements.

[0016]Systems and methods consistent with the present invention provide investors with the means to select an investment group based on a set of selection criteria consisting of a buyback ratio and price / sales or price / earnings ratio to improve investment return.

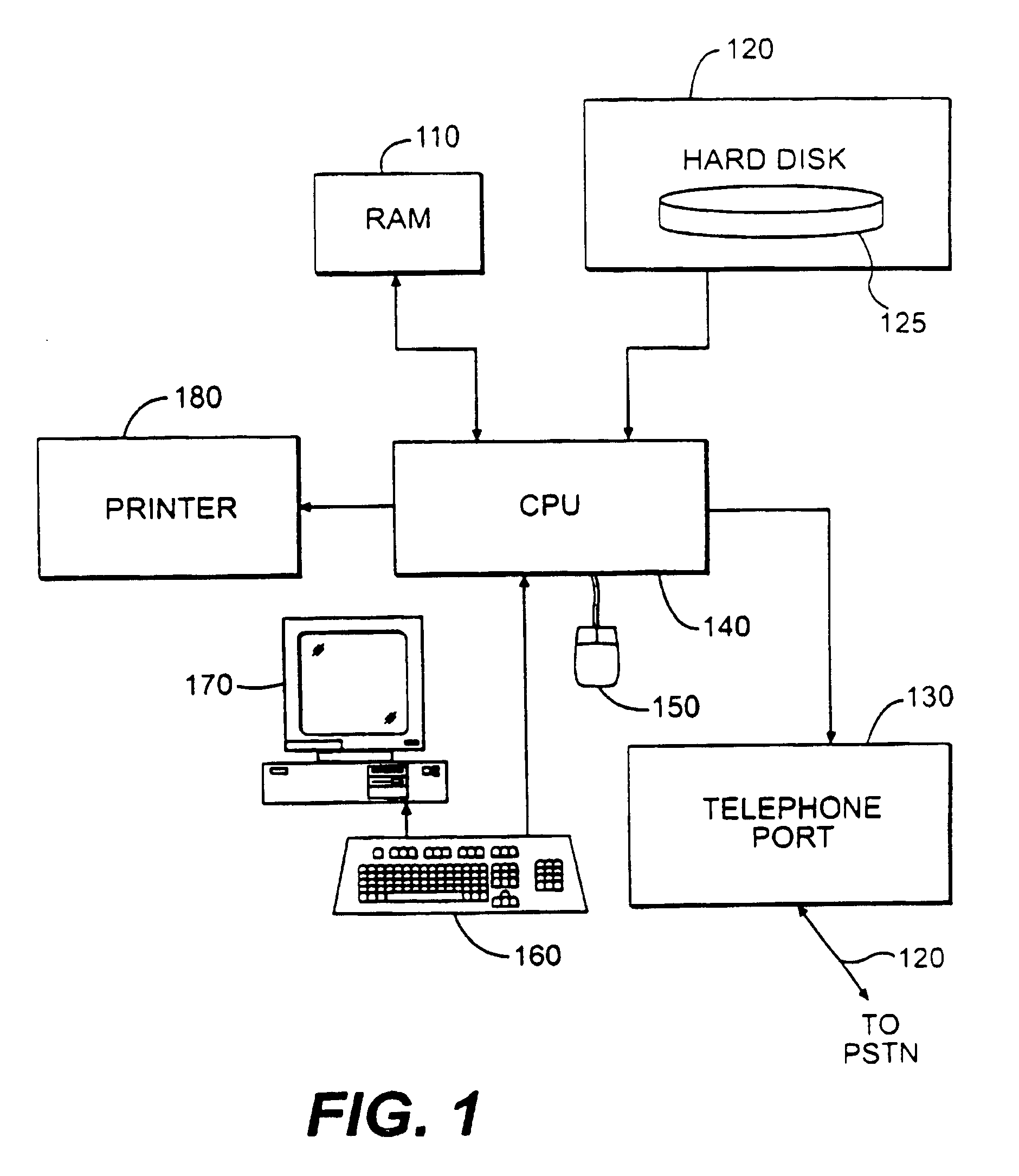

[0017]FIG. 1 is a block diagram showing a computerized system for generating a buyback stock report. Preferably, system 100 comprises a standard computer terminal capable of receiving user initiated input commands, processing data, and outputting the results for the user (for example, an IBM compatible personal computer would meet these requirements). System 100 consists of RAM 110, hard disk 120, telephone port 130, Central Processor Unit (CPU) 140, mouse 150, keyboard 160, video display 170, and a printer 180. These com...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com