Method based on cyclic neural network for predicting stock index price

A cyclic neural network, price prediction technology, applied in the field of stock index price prediction based on cyclic neural network, can solve the problems of explosion, gradient vanishing gradient, difficult to obtain time series dependencies, etc.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0039] The technical solution of the present invention will be further described below with reference to the accompanying drawings.

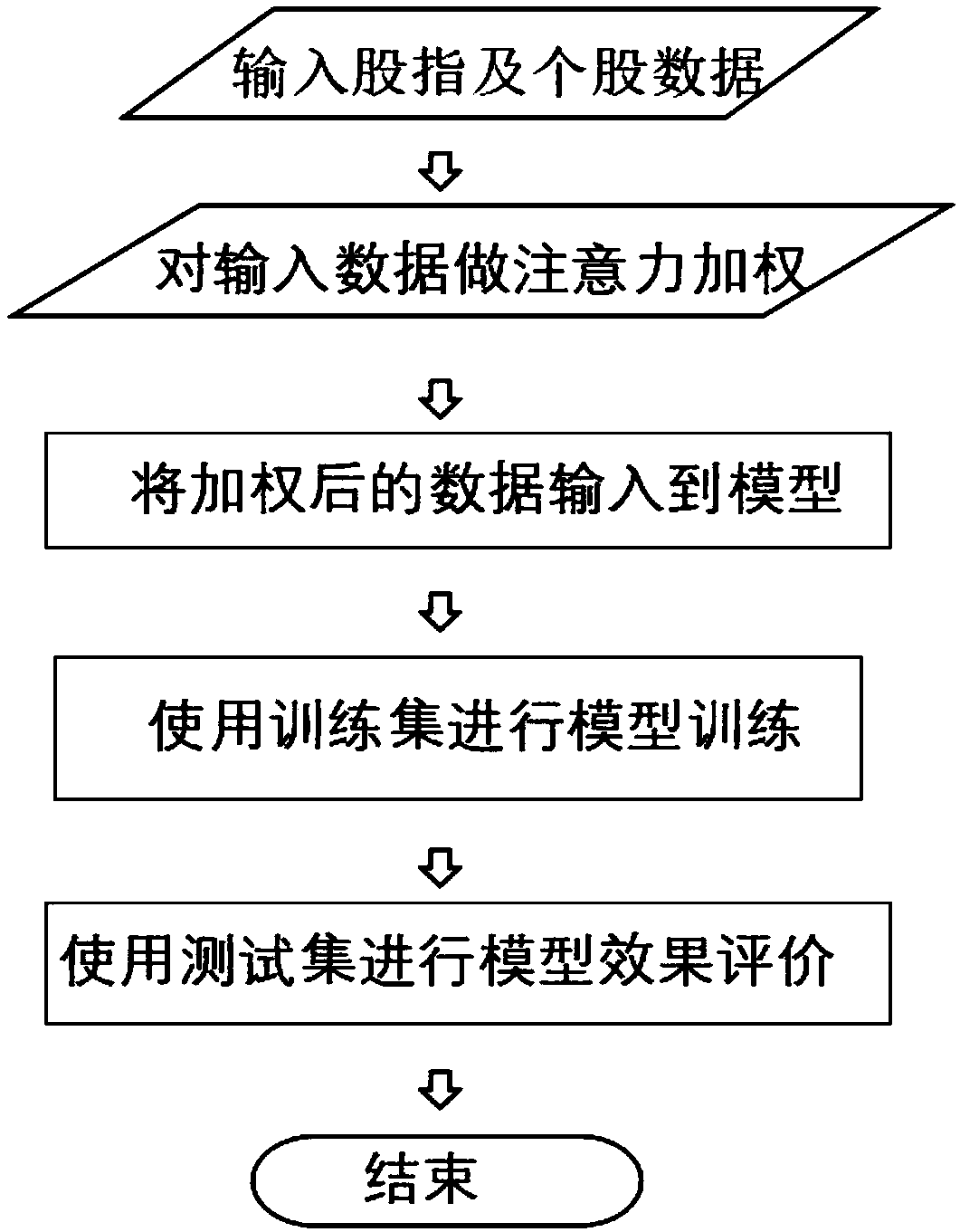

[0040]A stock index price prediction method based on a recurrent neural network, comprising the following steps:

[0041] 1) Clean and process the historical data of the stock index and its individual stocks;

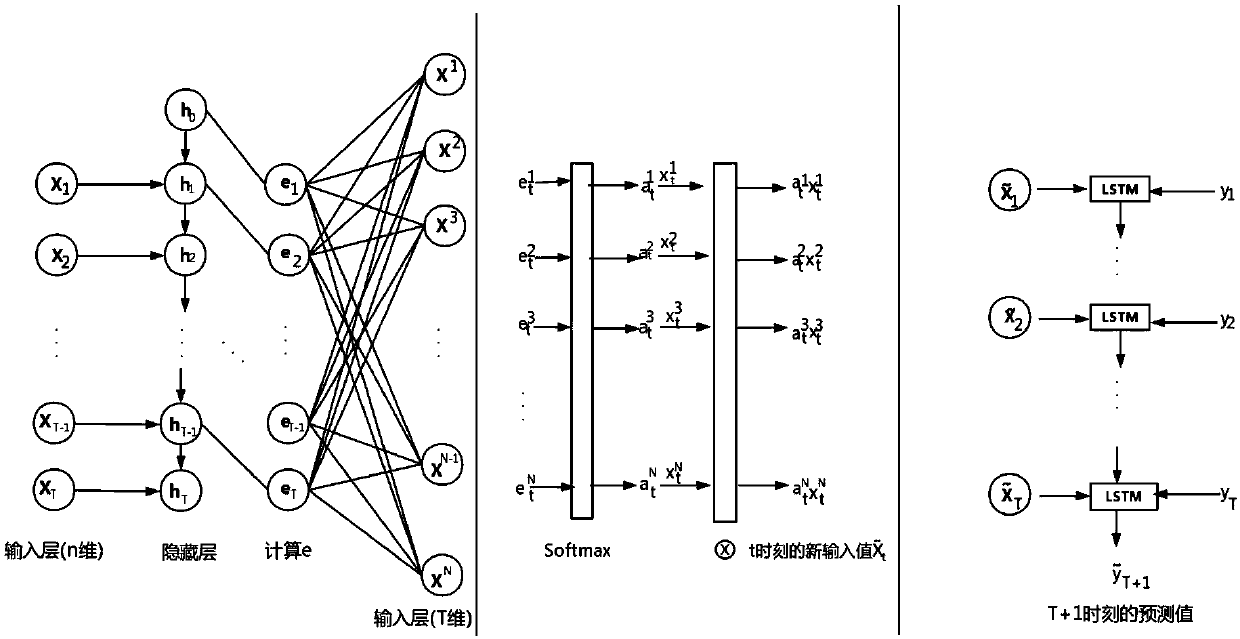

[0042] 2), the data processed in step 1) is carried out as follows figure 1 Attention weighting adjustments shown on the left;

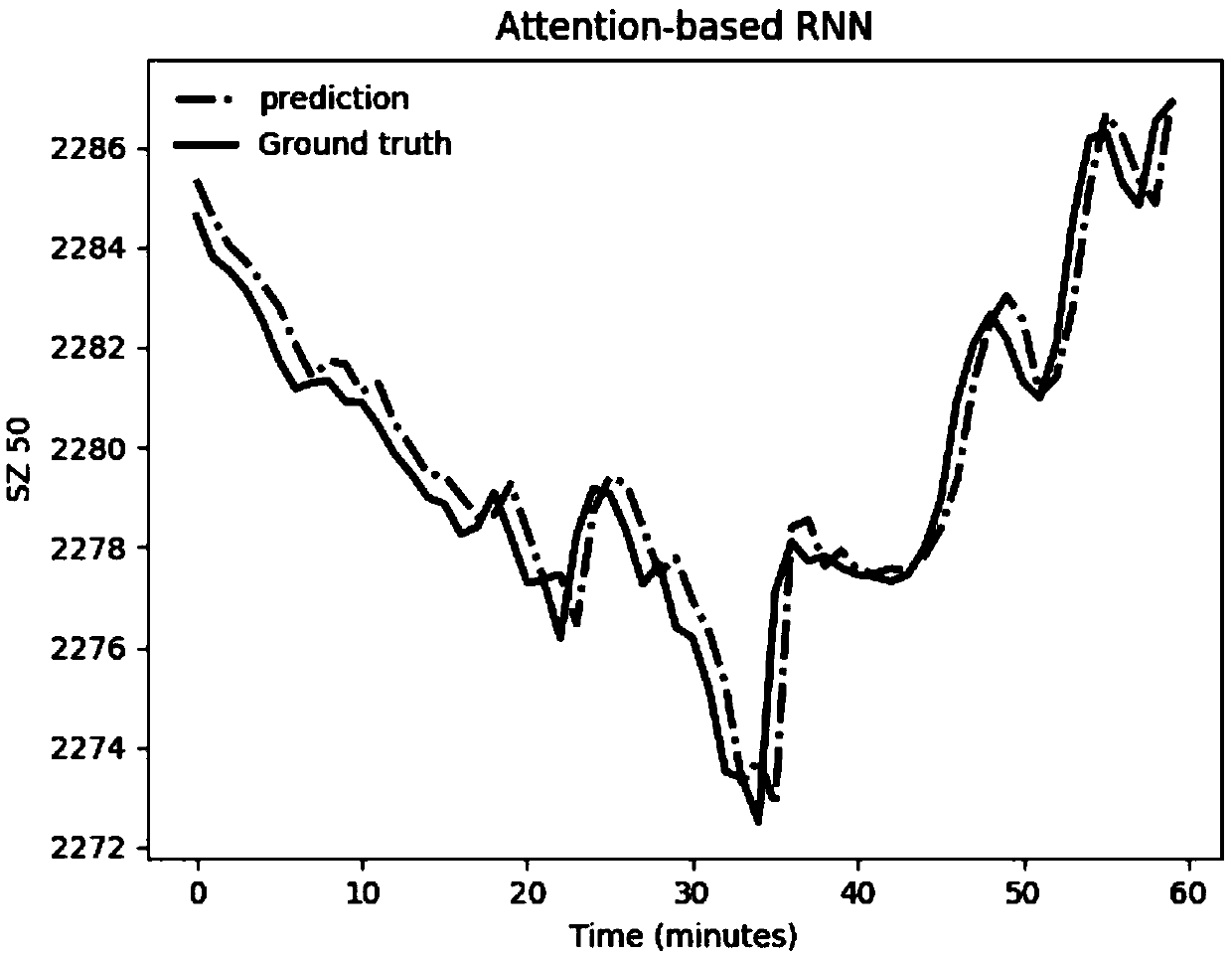

[0043] 3), after determining the value of the hyperparameter, training such as figure 1 For the network shown, get the corresponding parameter values, and then perform the operations described in the above steps on the closing price of the SSE 50 stock index to get the corresponding forecasting effect figure 2 .

[0044] The stock index price prediction method based on the cyclic neural network has basically the same function as the existing traditional cyclic neural network forecasting time series method. ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com