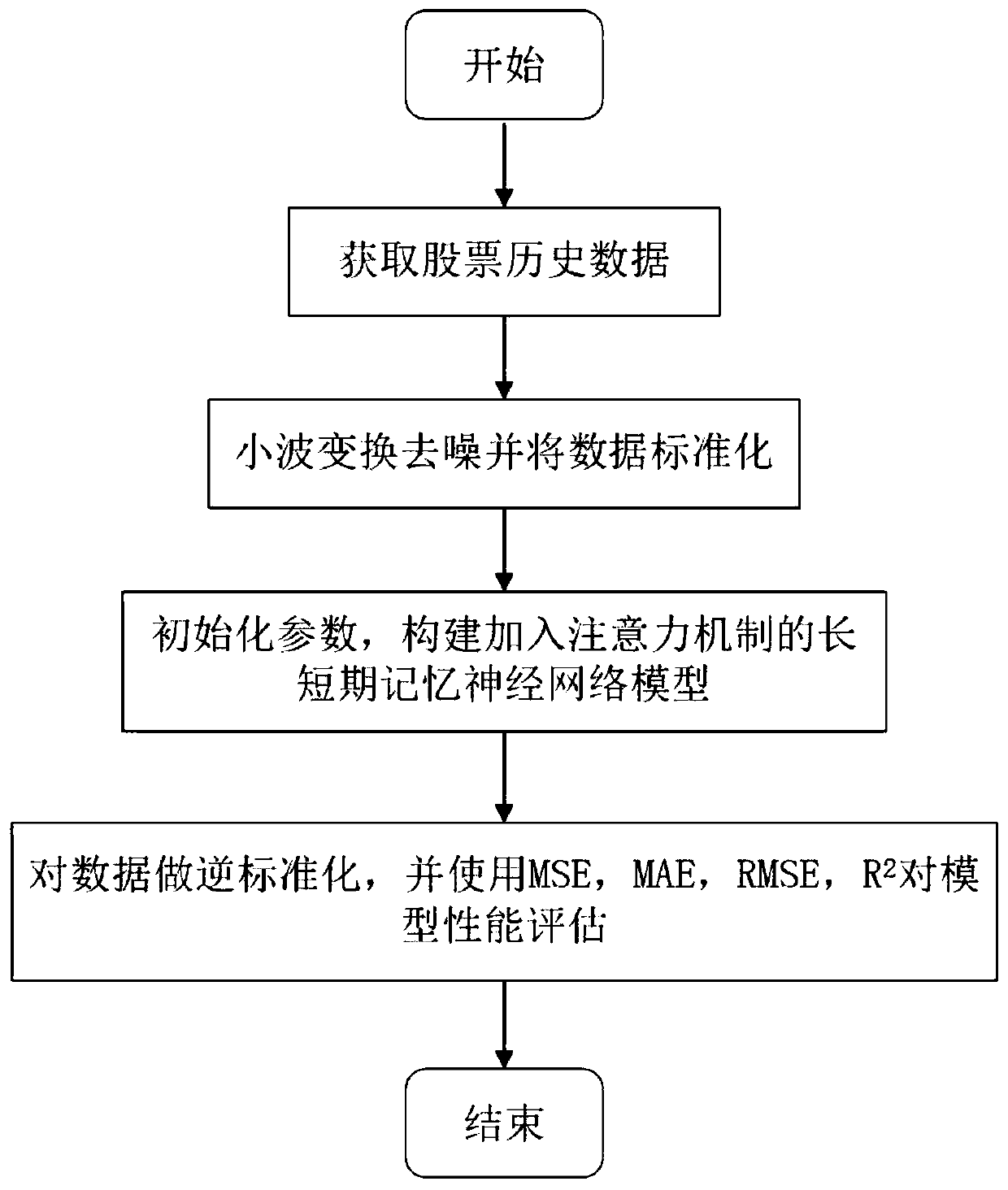

Stock price prediction method of long-term and short-term memory neural network based on attention mechanism

A technology of long-term short-term memory and neural network, which is applied in the field of stock price prediction of long-term short-term memory neural network, can solve the problem that the stock price prediction model cannot produce ideal prediction results, and achieve good prediction and improve the effect of accuracy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

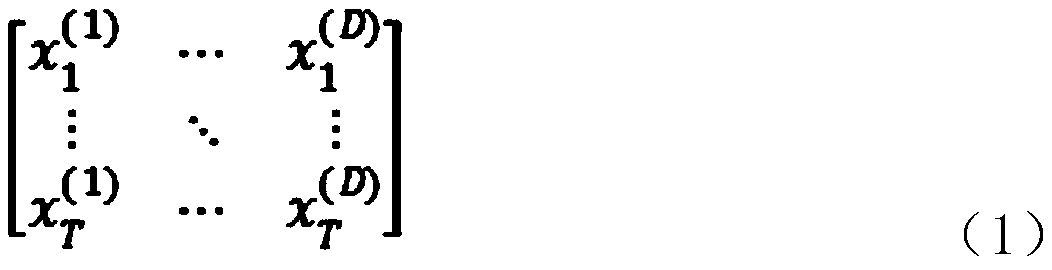

[0044] This example uses the Standard & Poor's 500 Index (S&P500), the Dow Jones Industrial Average (DJIA) and the Hang Seng Index (HSI) as historical data sets, where the data of S&P 500 and DJIA are from January 3, 2000 to 2019 On July 1, 2002, the data of HSI is from January 2, 2002 to July 1, 2019. There are 6 basic variables in each data set, including opening price, closing price, highest price, lowest price, adjusted closing price , volume, and divide the historical data set into a training set and a test set;

[0045] Standardize the training set and test set, and use wavelet transform to further process the standardized data. The wavelet basis function uses coif 3, and the number of decomposition layers, threshold and threshold function are determined by parameter adjustment;

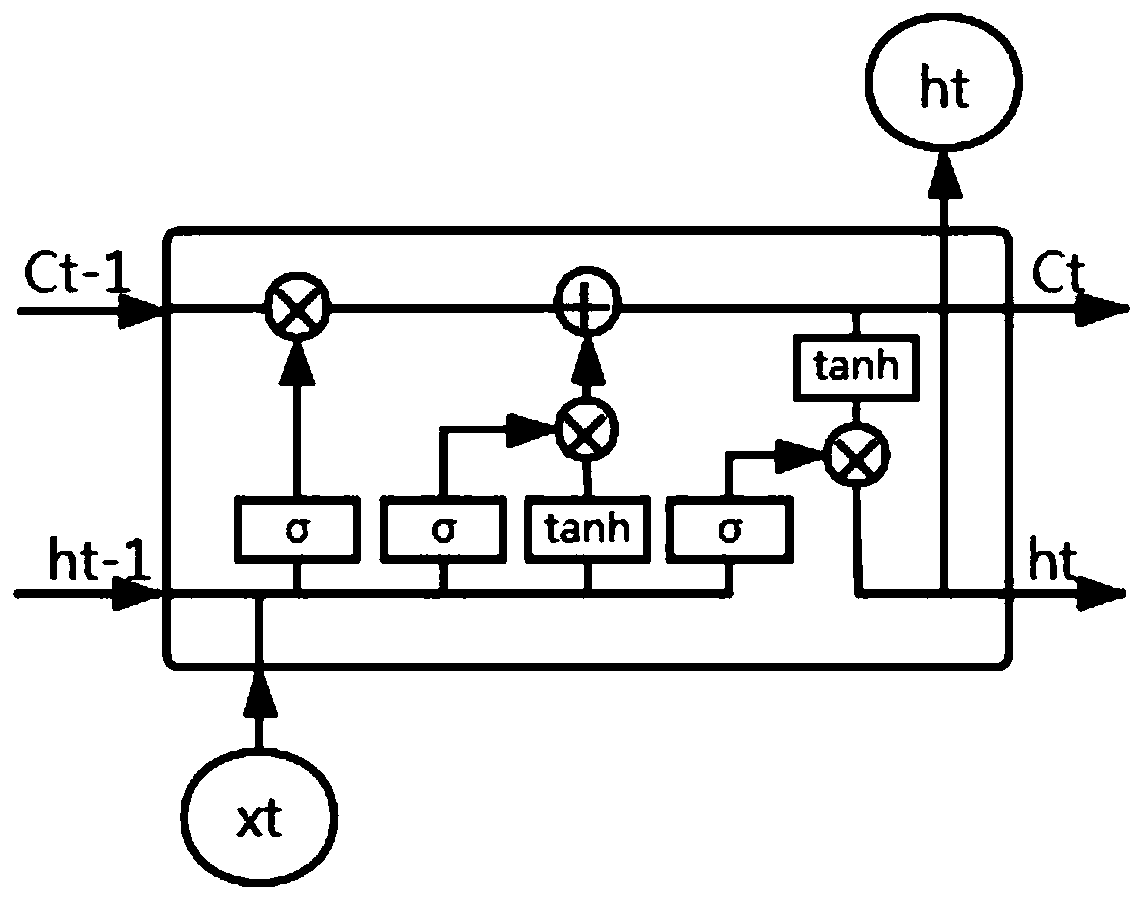

[0046] Initialize the parameters and build a long short-term memory neural network prediction model with 9 hidden neurons (as attached figure 2 shown), and use the training set whose step siz...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com