Generating an annuity payment using a dynamic asset allocation investment

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

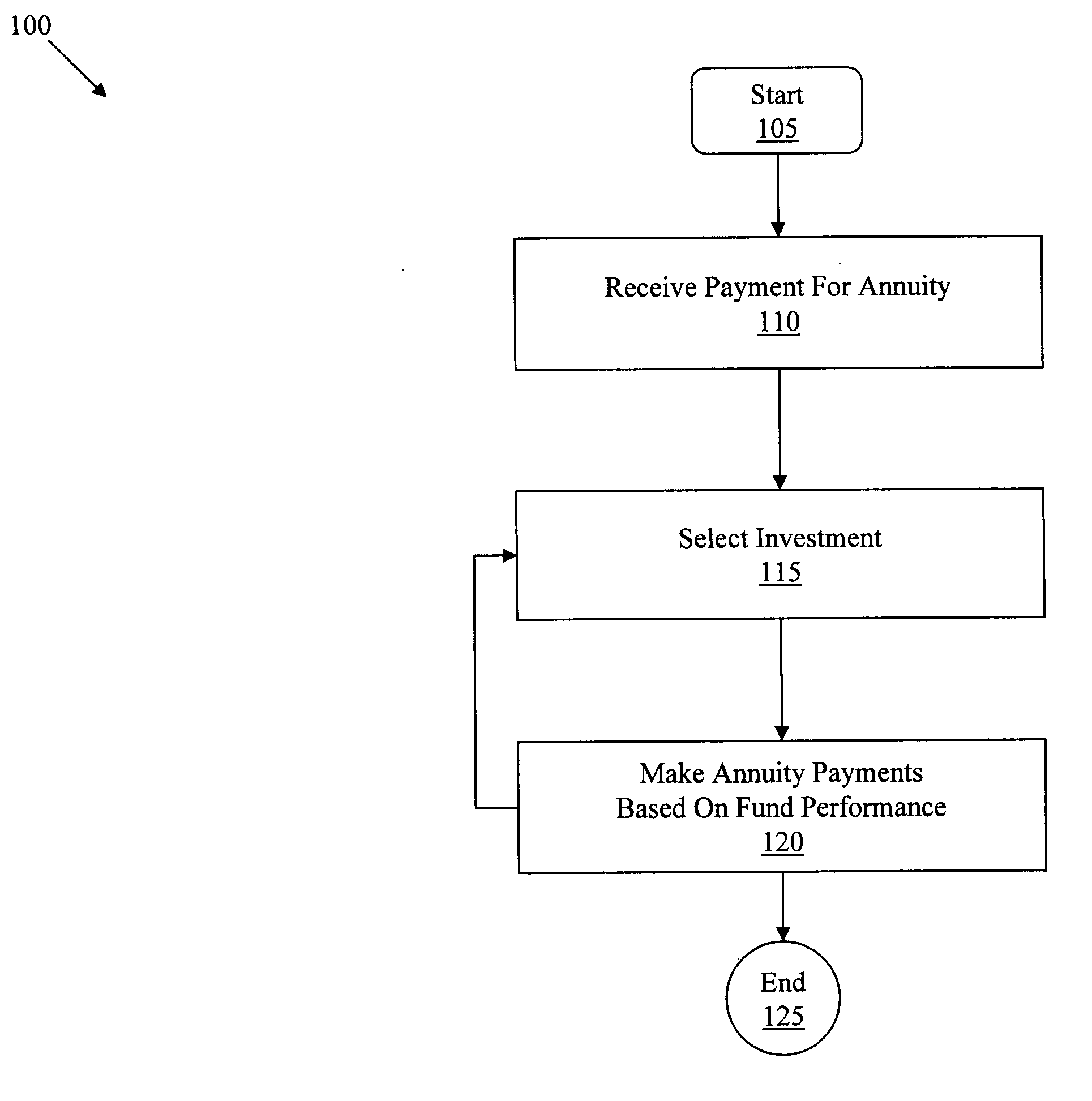

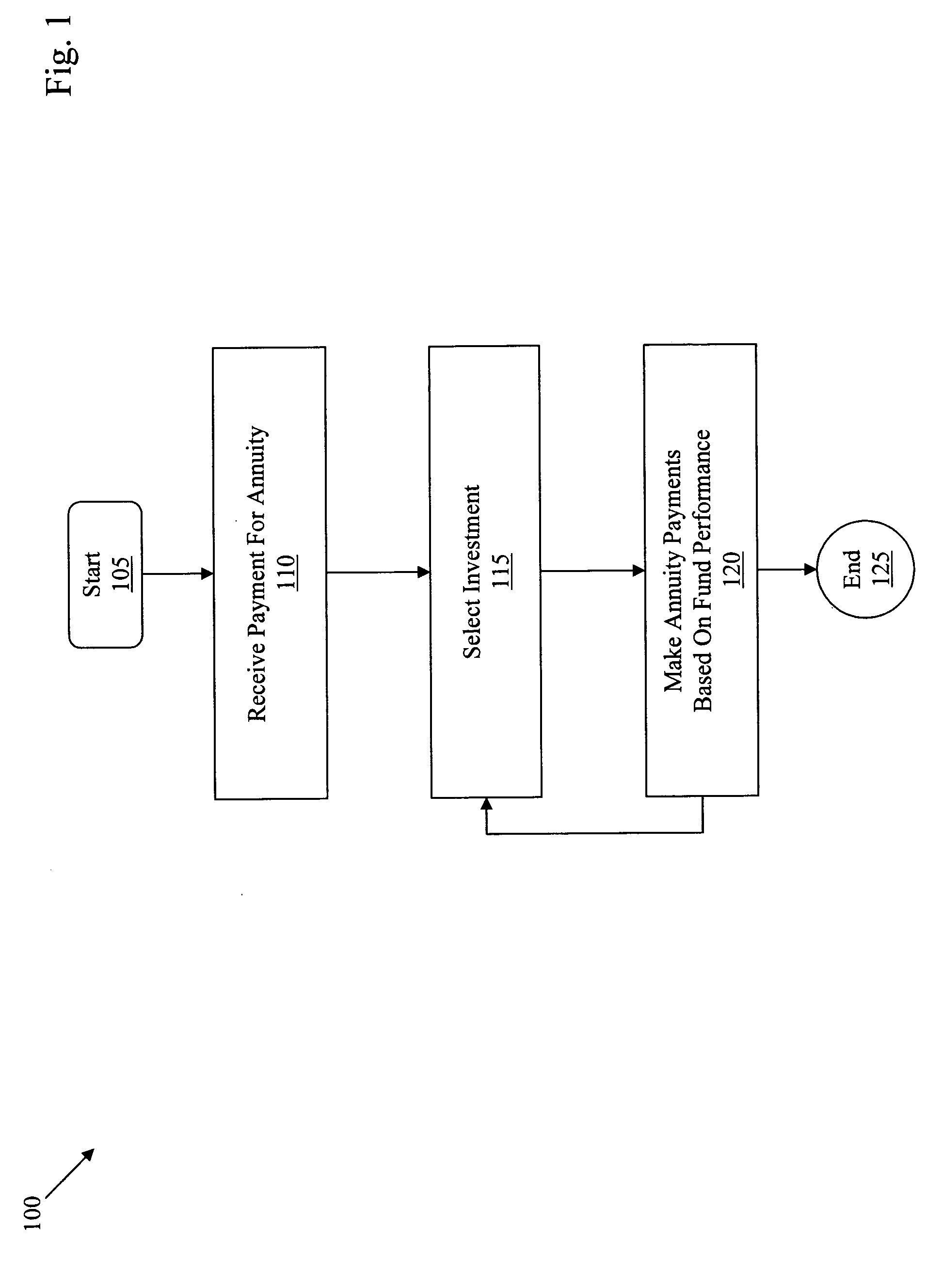

[0021]FIG. 1 is a process 100 that depicts the creation and lifecycle of an immediate annuity. The process 100 begins (105) by the annuity provider receiving (110) payment for the annuity. The payment is typically a lump sum amount that the contract holder pays to an annuity provider (e.g., an insurance company) in exchange for the annuity provider's promise to provide an annuitant (typically the same individual that bought the annuity, i.e., the contract holder) with an income stream of an estimated amount for the remainder of her life. Then the contract holder selects (115) an investment (e.g., a specialized fund) based on, for example, the annuitant's demographic information (e.g., age, gender, and / or other factors that can affect life expectancy). The contract holder is, in effect, buying an income stream that changes based on the performance of an investment, for the rest of the annuitant's life. Advantageously, such choice enables the income stream to increase over time based ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com